030323 Morning Session Analysis

03 March 2023 Morning Session Analysis

Greenback buoyed amid decent labor data.

The dollar index, which is traded against a basket of six major currencies, regained its luster yesterday’s night following the release of an upbeat labor data. According to the US Department of Labor, the number of American who filed for unemployment claims over the past one week dropped from 192K to 190K, beating the consensus forecast at 195K, mirroring that the US labor market remained resilient. The upbeat labor data missed the sharp increase in unemployment across the US economy, proved by the major layoff by the giant companies in the country. However, the buying momentum in the US dollar seemed limited as the market participants are waiting for the crucial labor data – NonFarm Payrolls, which will be announced on 10th March. Furthermore, the dollar index extended its bull rally, helped as US treasury yield hit the fresh high. With the persistent-high inflation, the markets have largely priced in a 25-basis point of rate hike in the upcoming meeting in March. At the meantime, the market expectations of a more aggressive rate hike are surging as well, as the recent strong economic data provided more room for the Federal Reserve to hike its rate further. As of writing, the dollar index rose 0.48% to 104.98.

In the commodities market, crude oil prices were up by 0.24% to $77.77 per barrel amid strong economic rebound in top crude importer China. Besides, gold prices edged down by -0.05% to $1835.75 per troy ounce as the US dollar retakes the crown amid strong labor data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Feb) | 53.0 | 53.0 | – |

| 17:30 | GBP – Services PMI (Feb) | 53.3 | 53.3 | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Feb) | 55.2 | 54.5 | – |

Technical Analysis

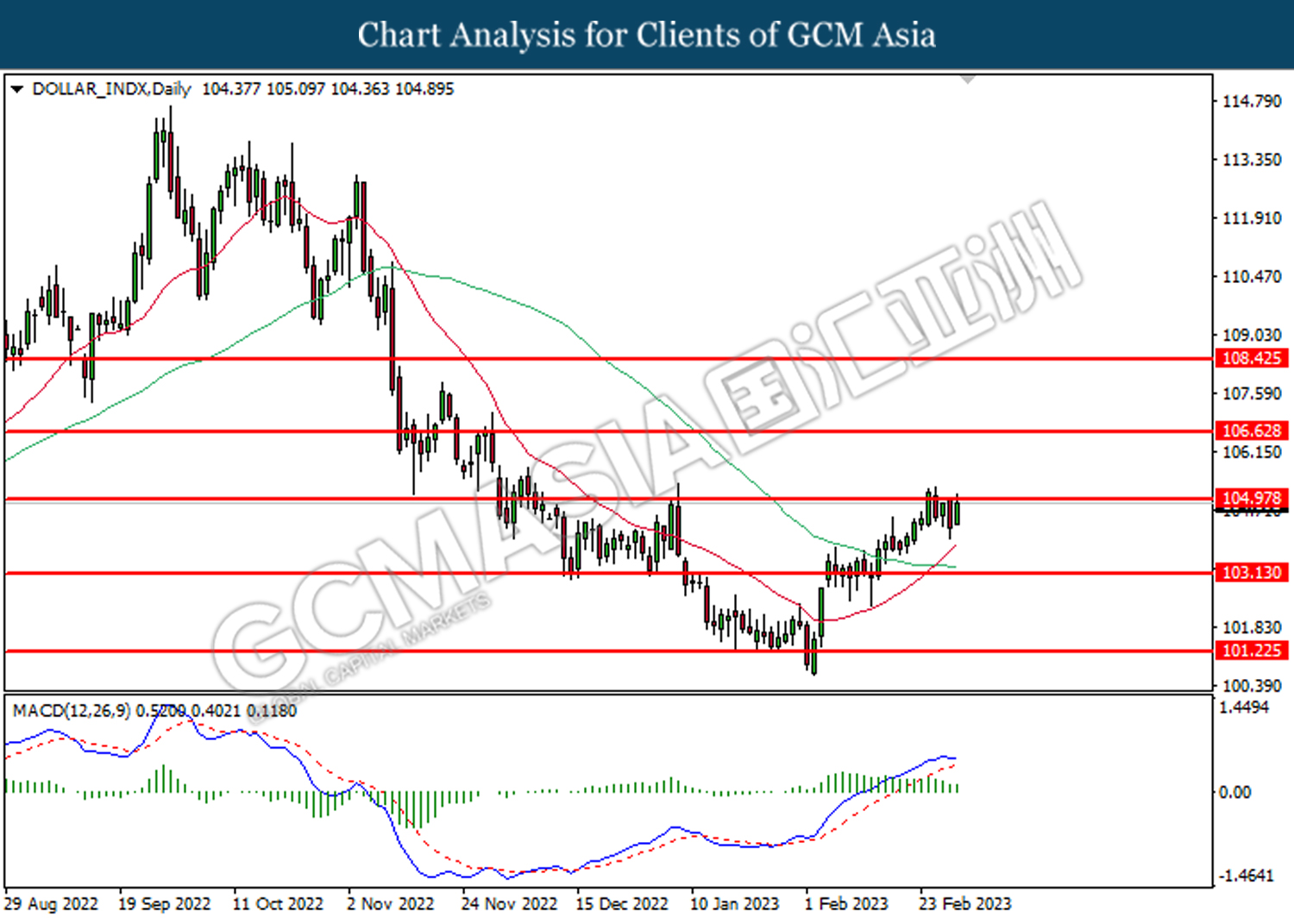

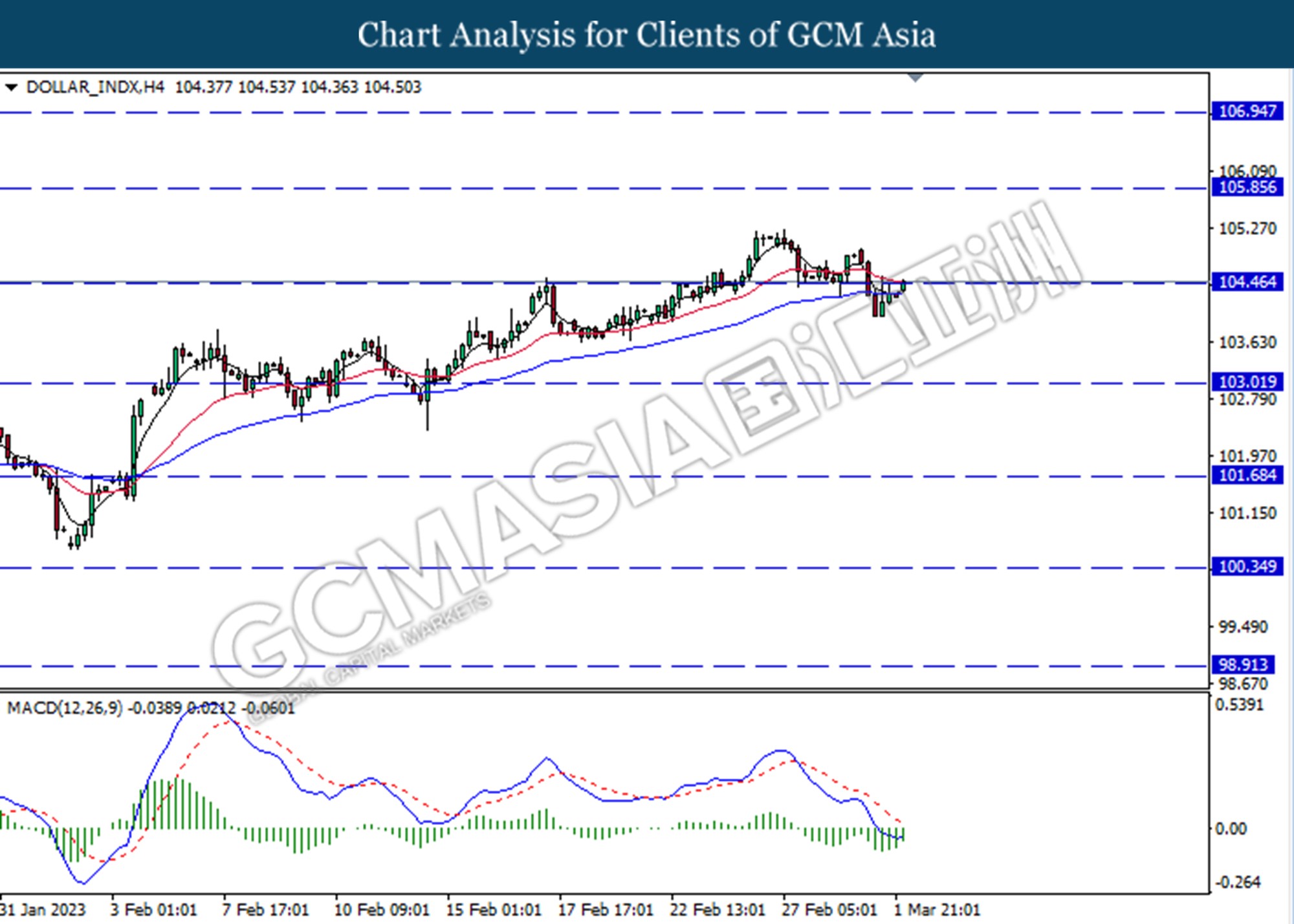

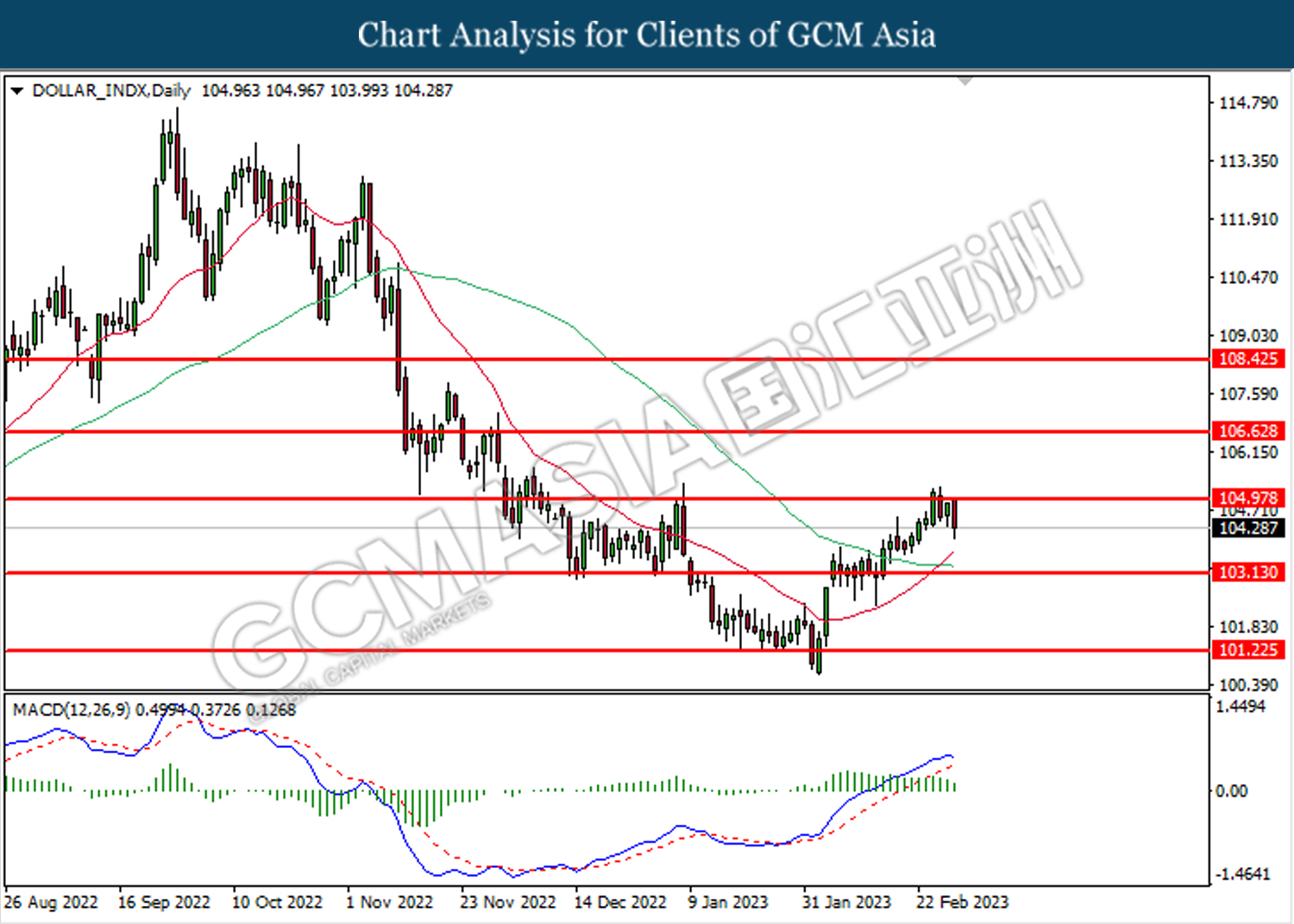

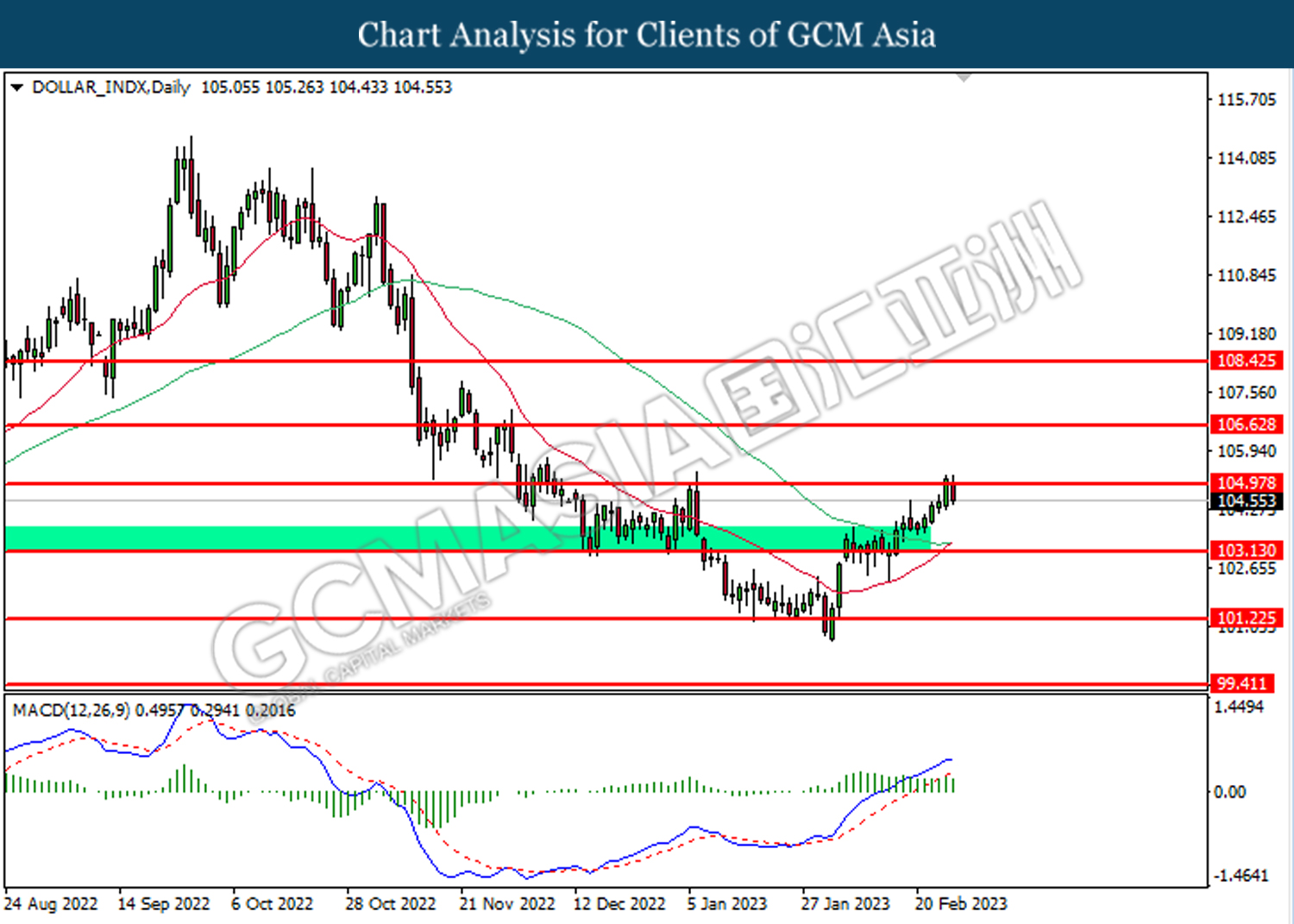

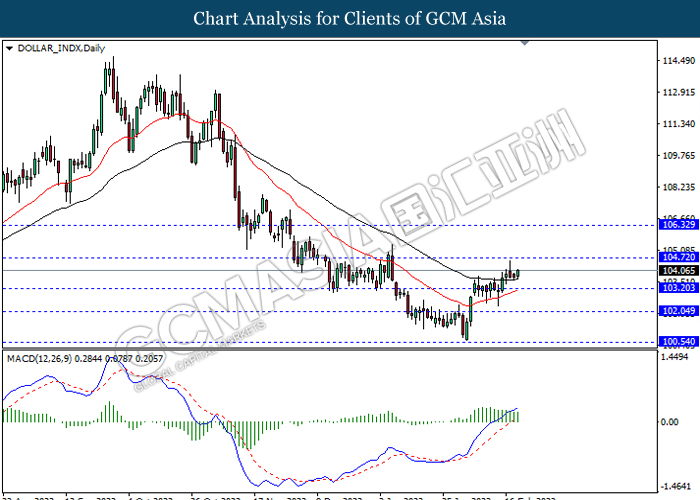

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior retracement from the resistance level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to undergo technical correction in short term.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

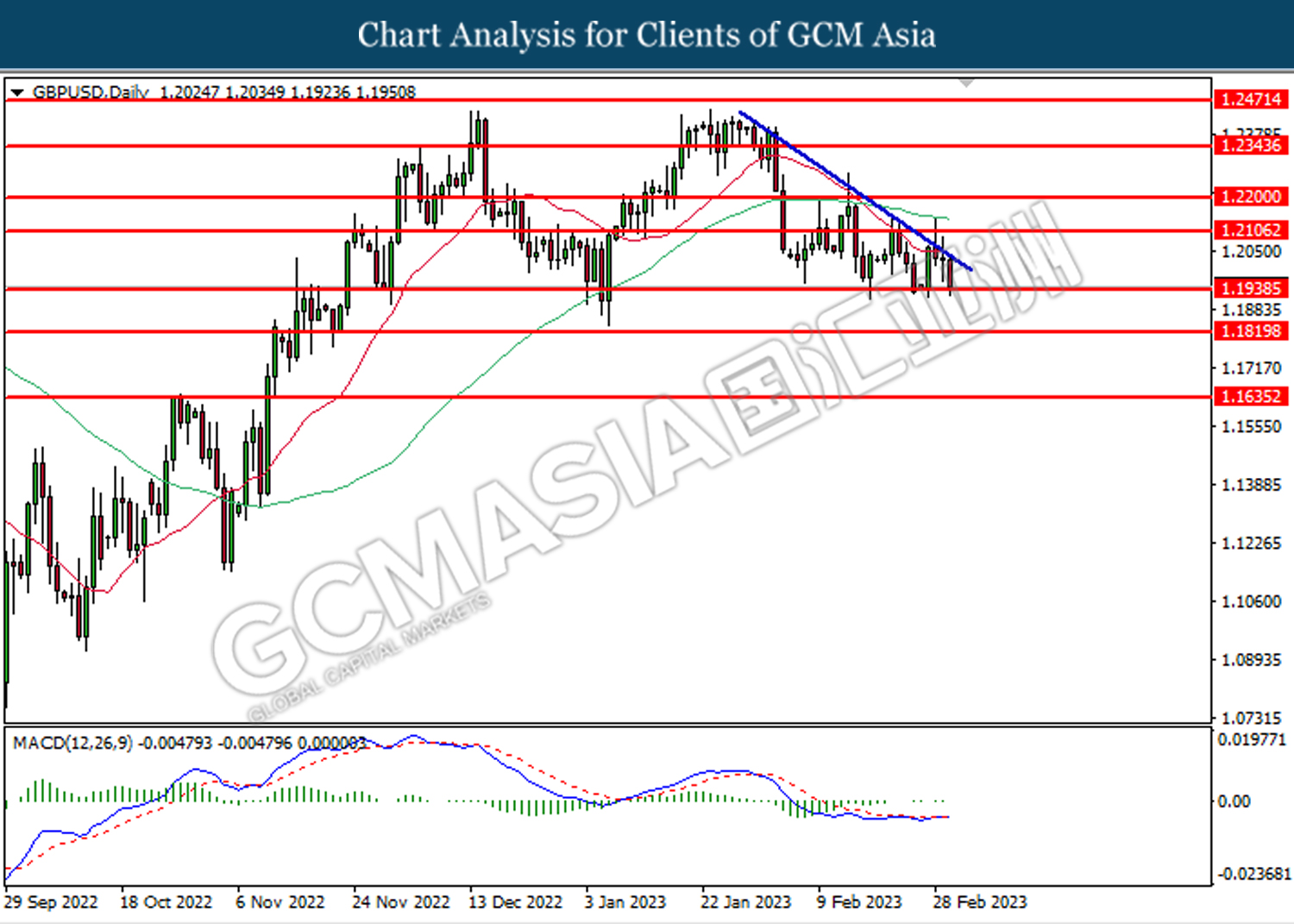

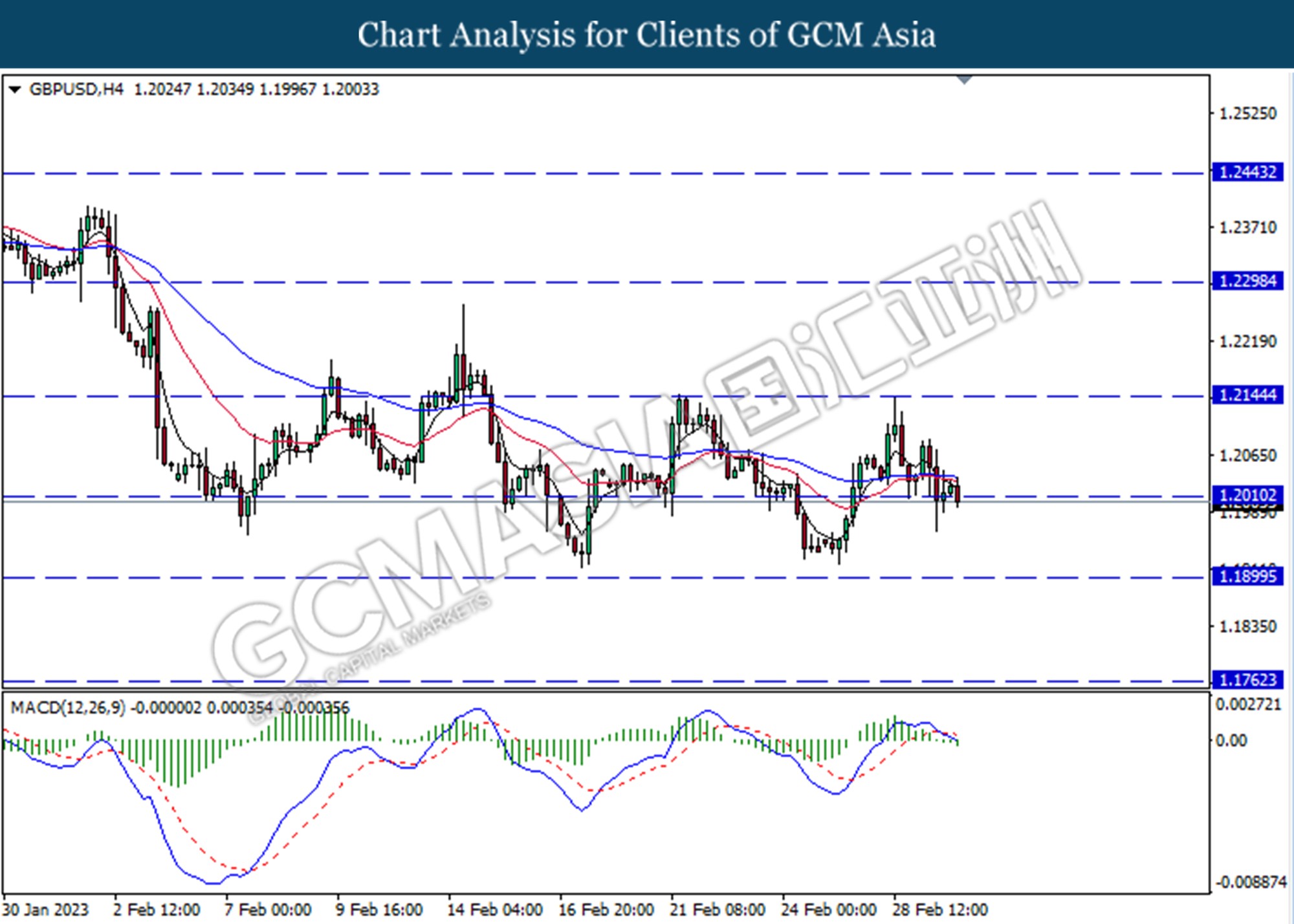

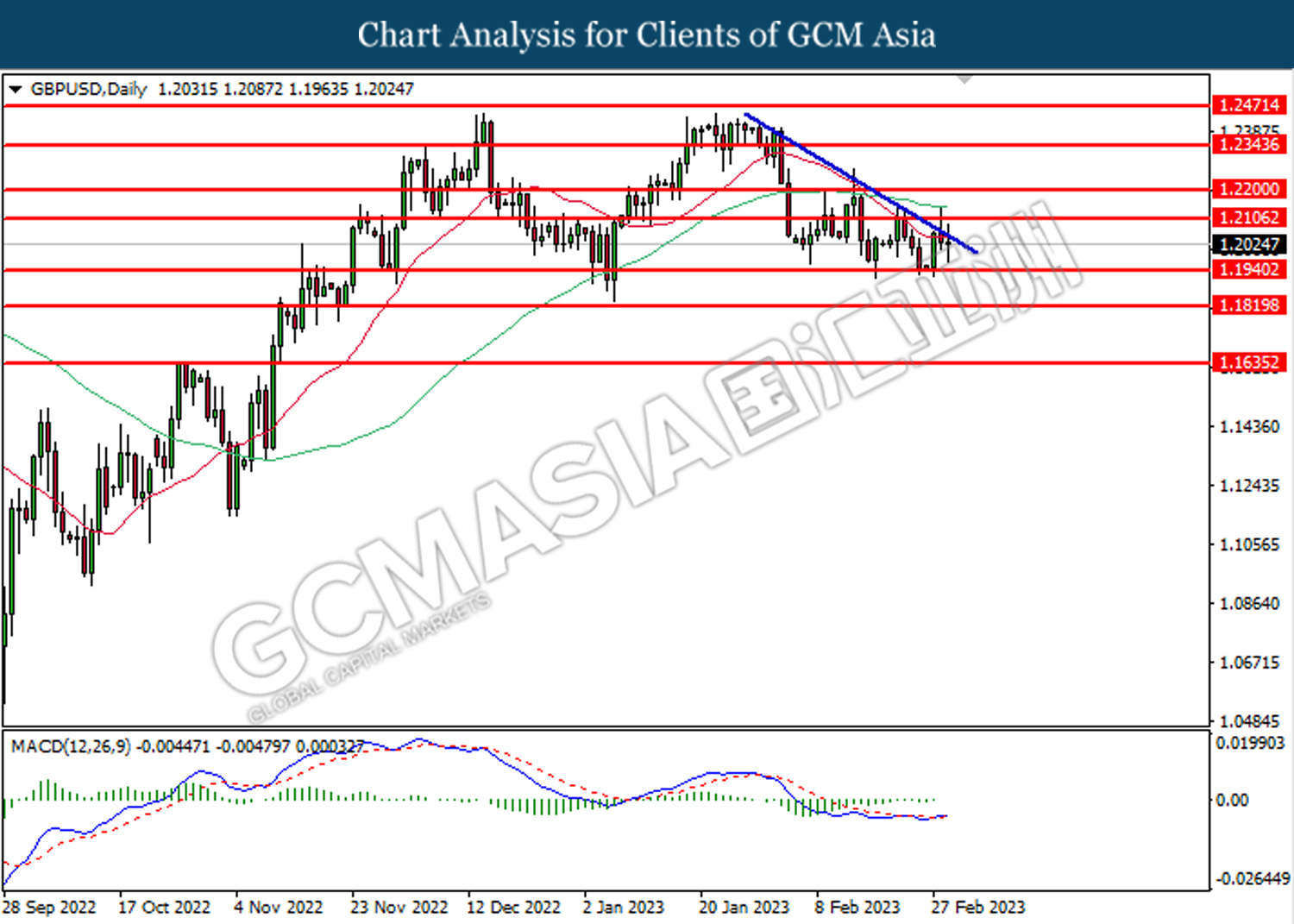

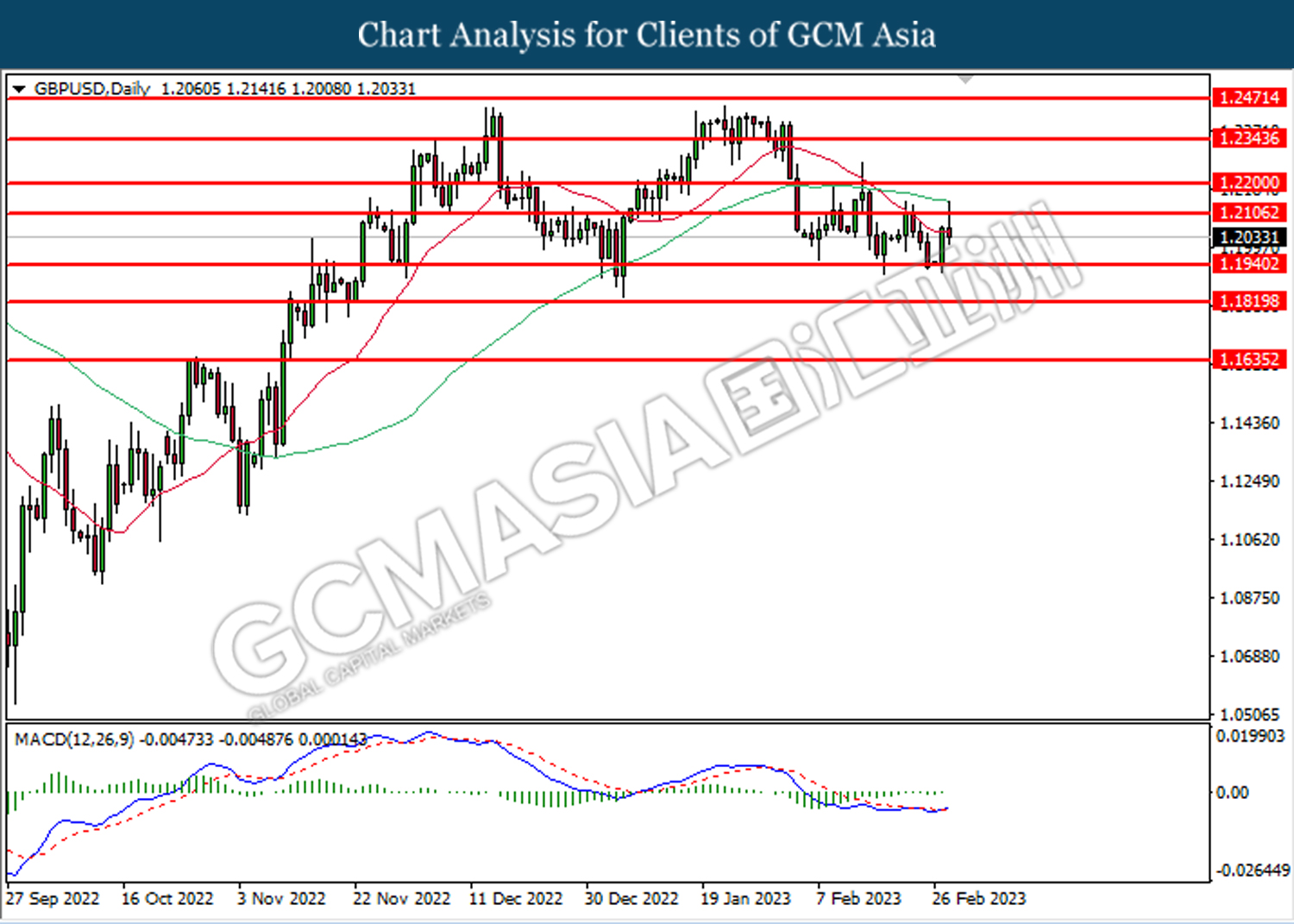

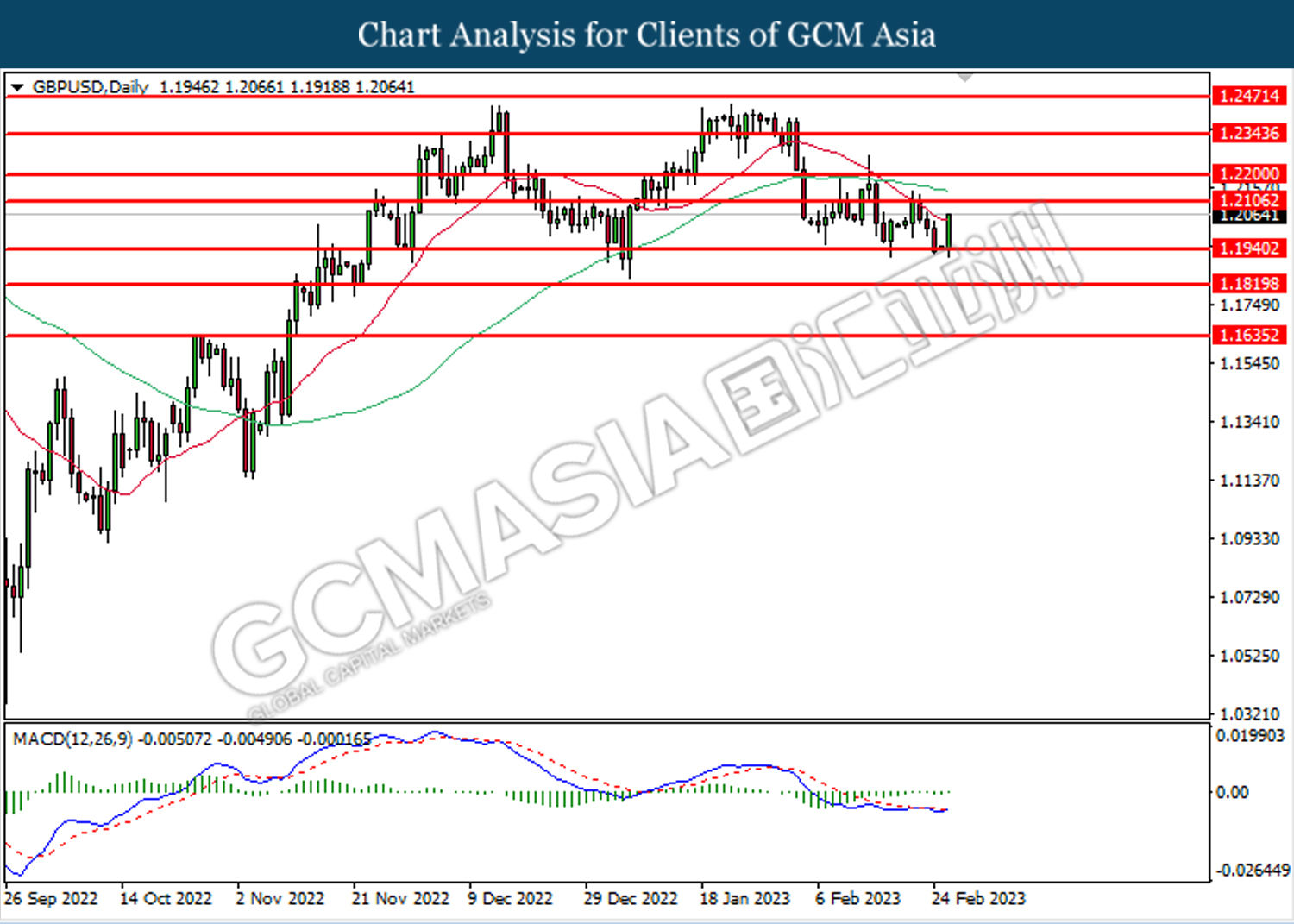

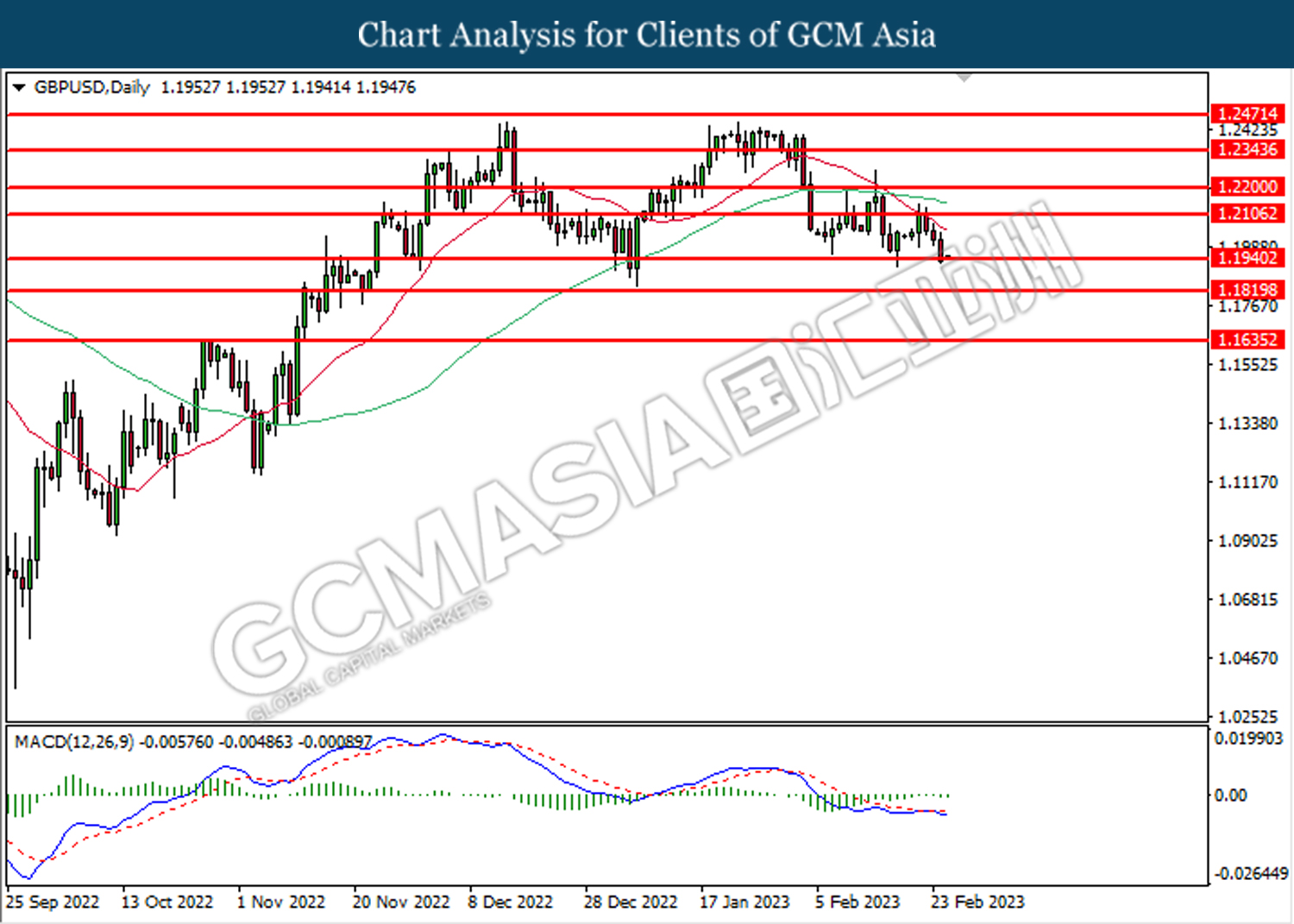

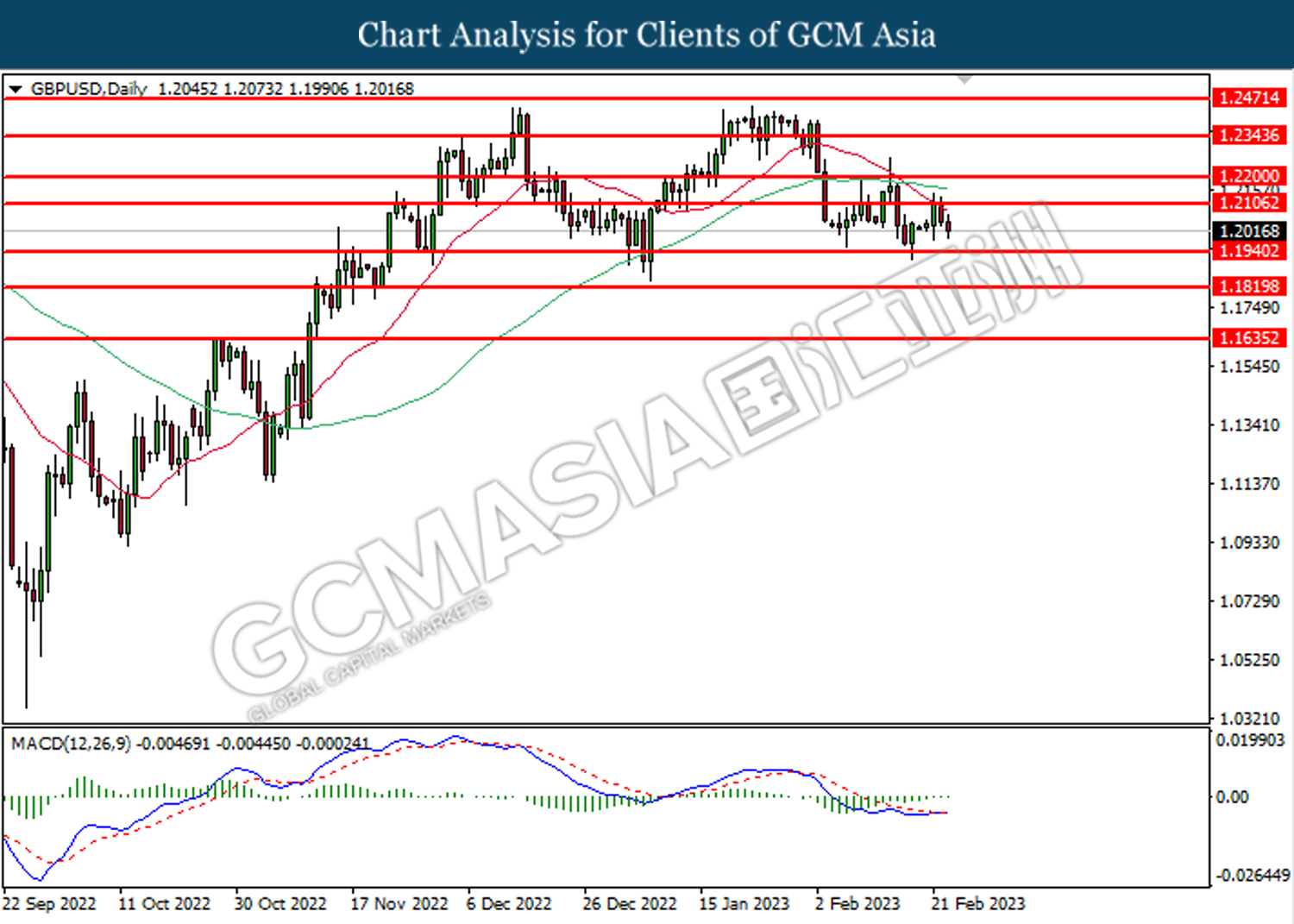

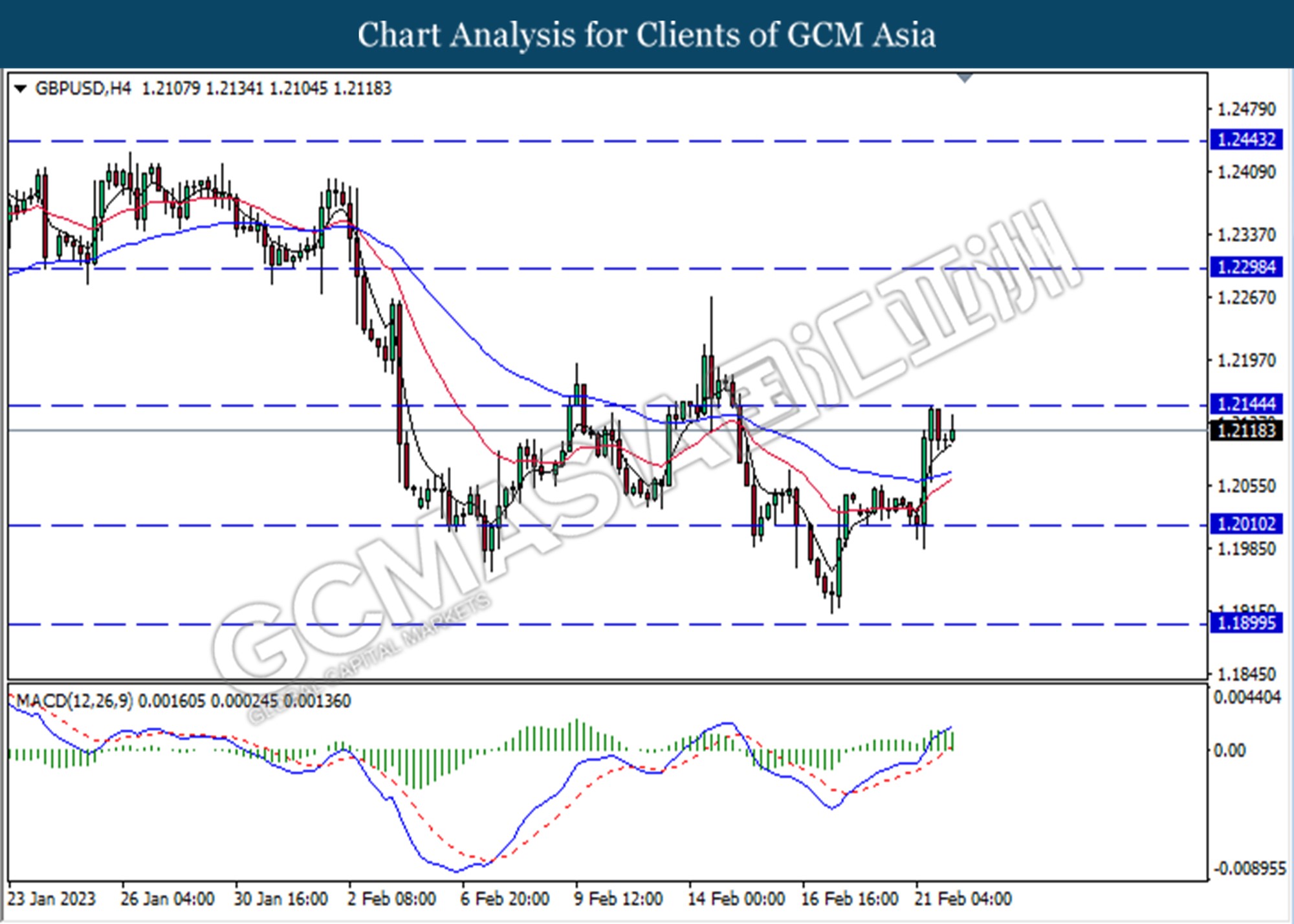

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1940. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

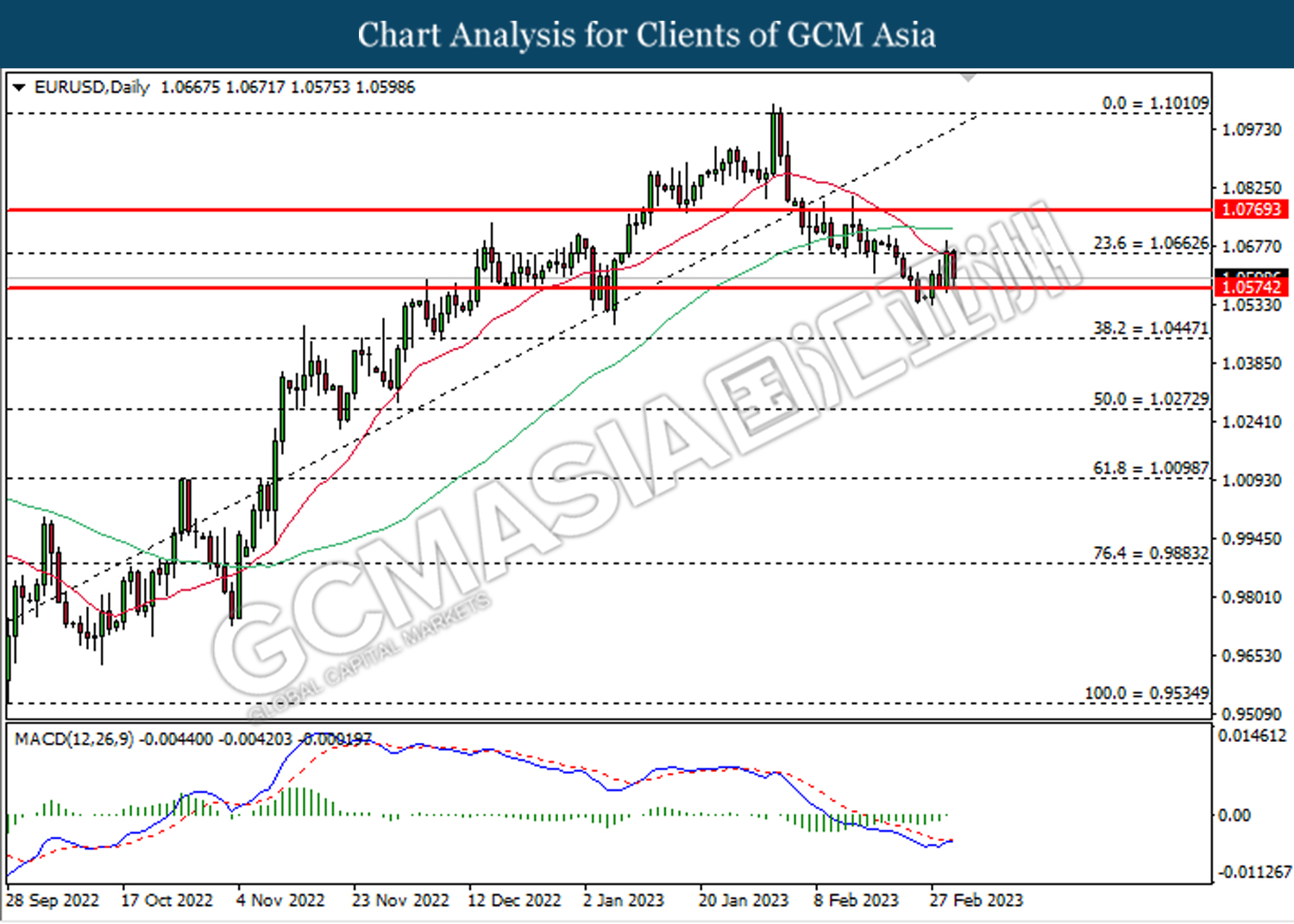

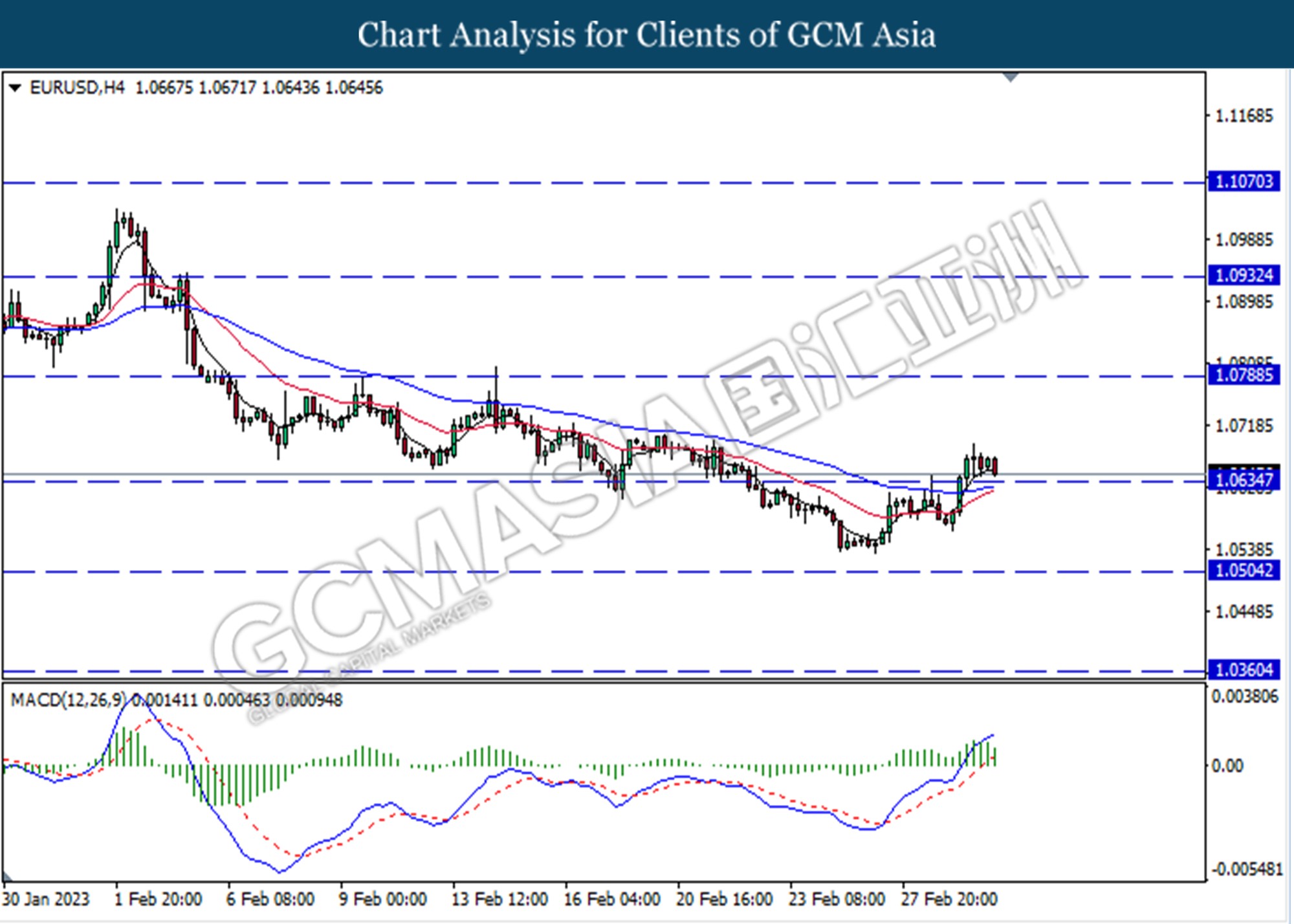

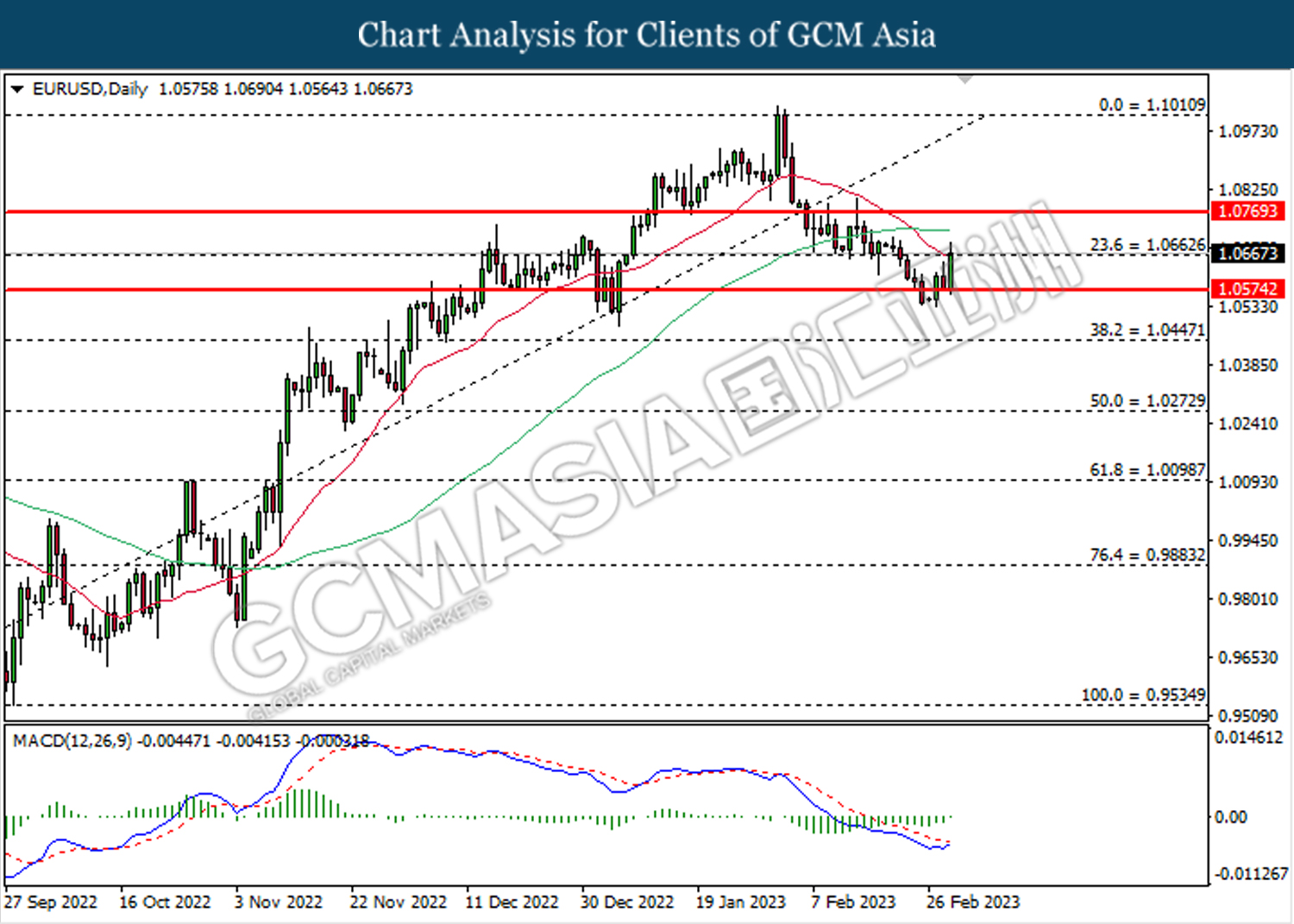

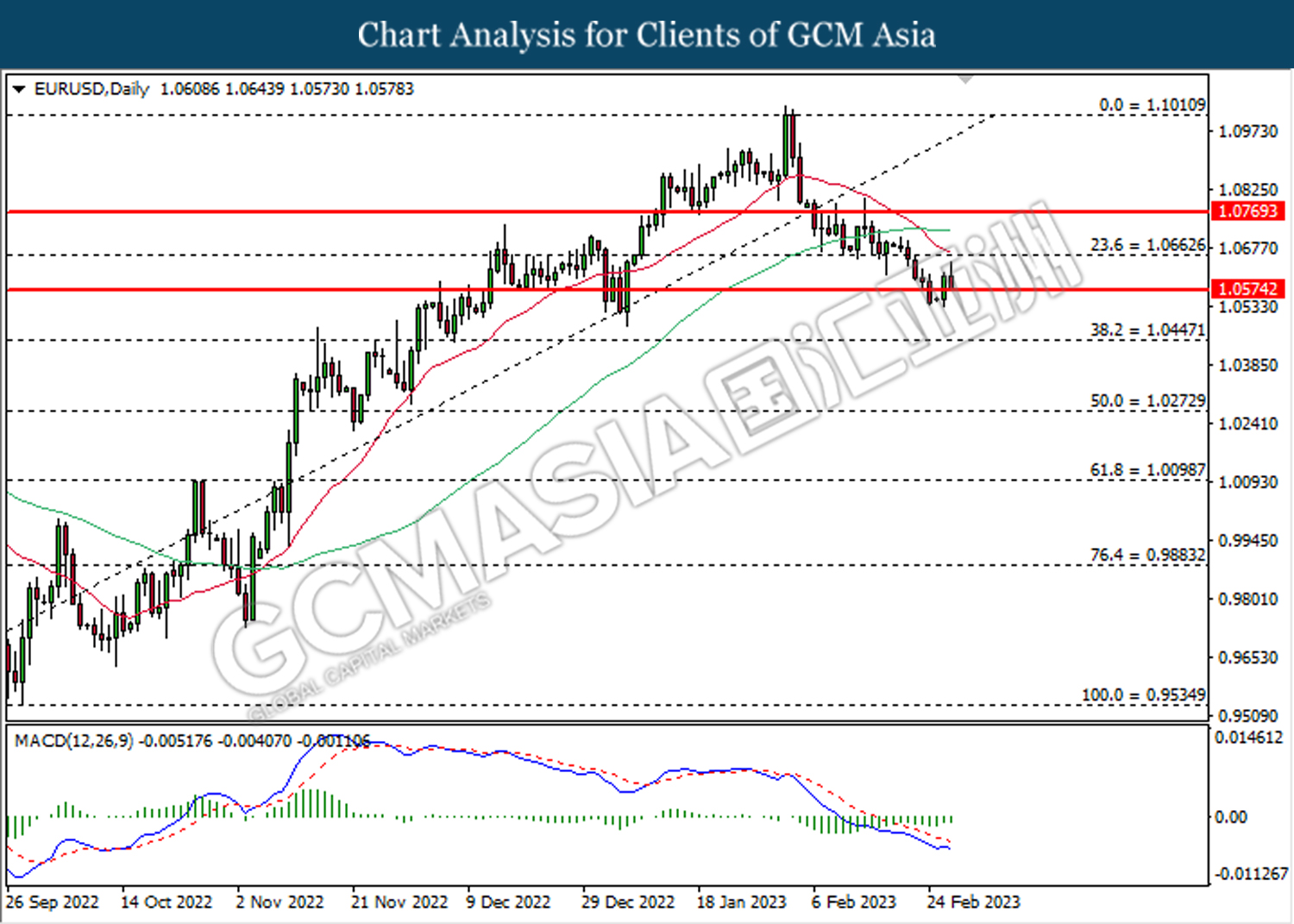

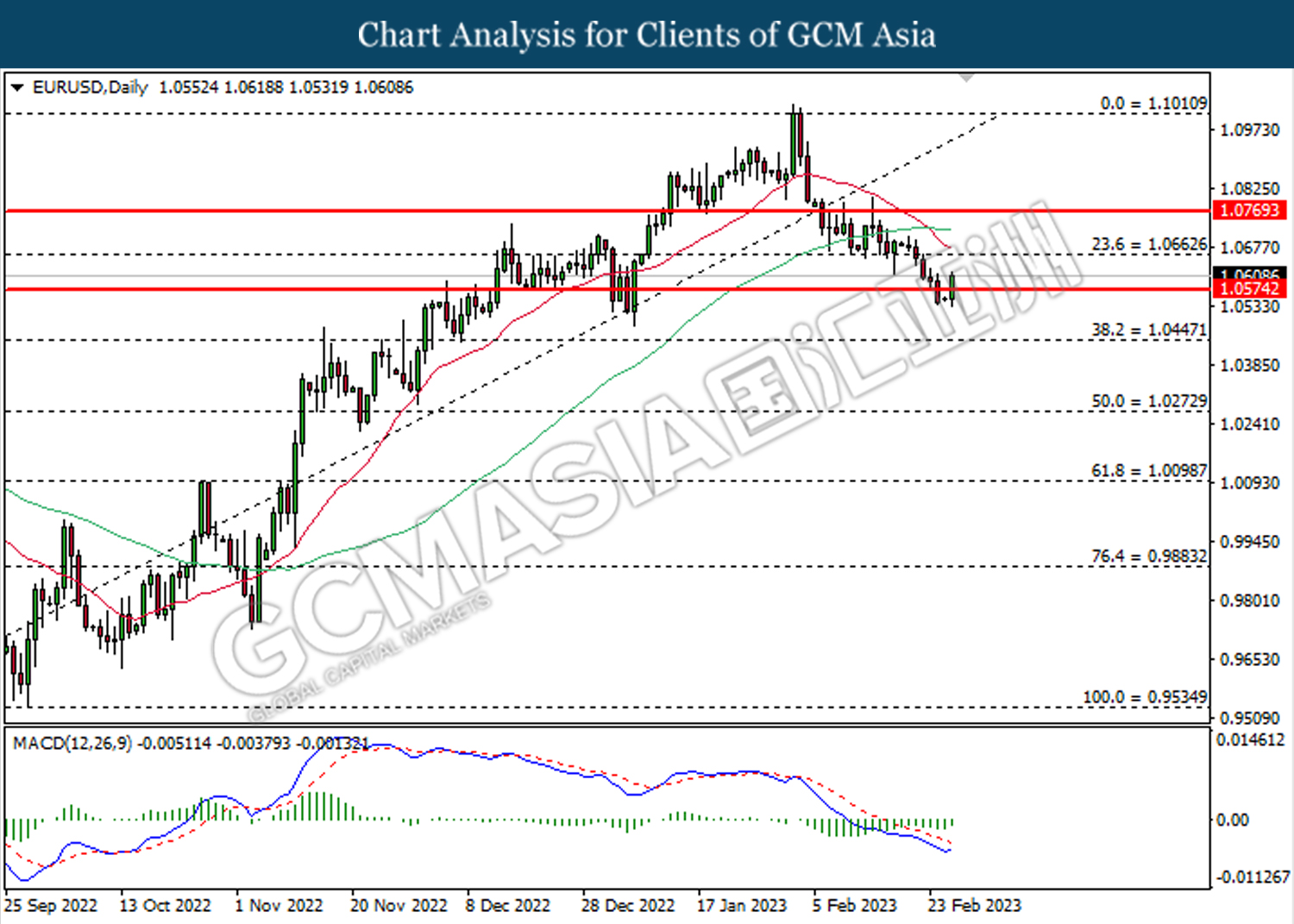

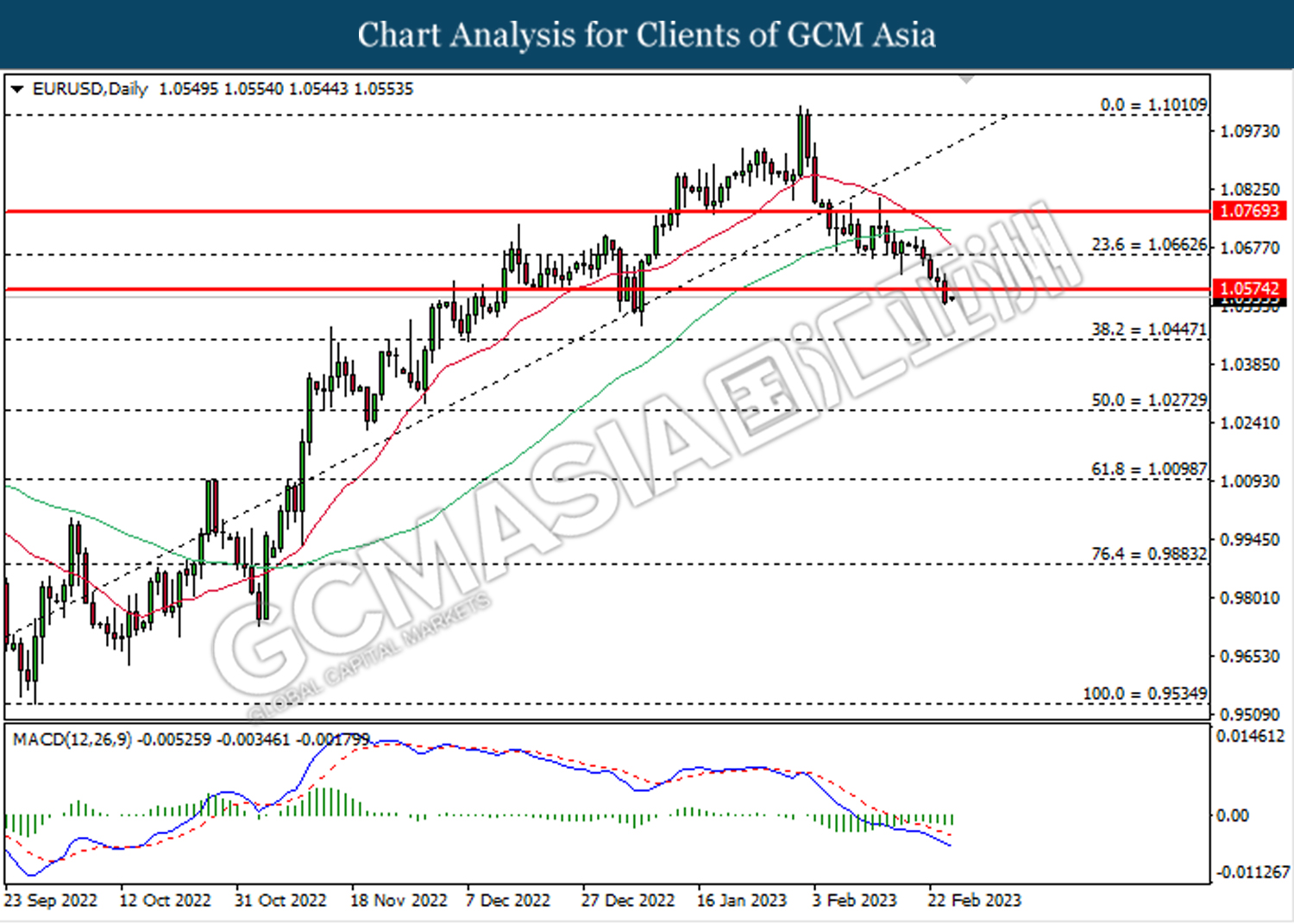

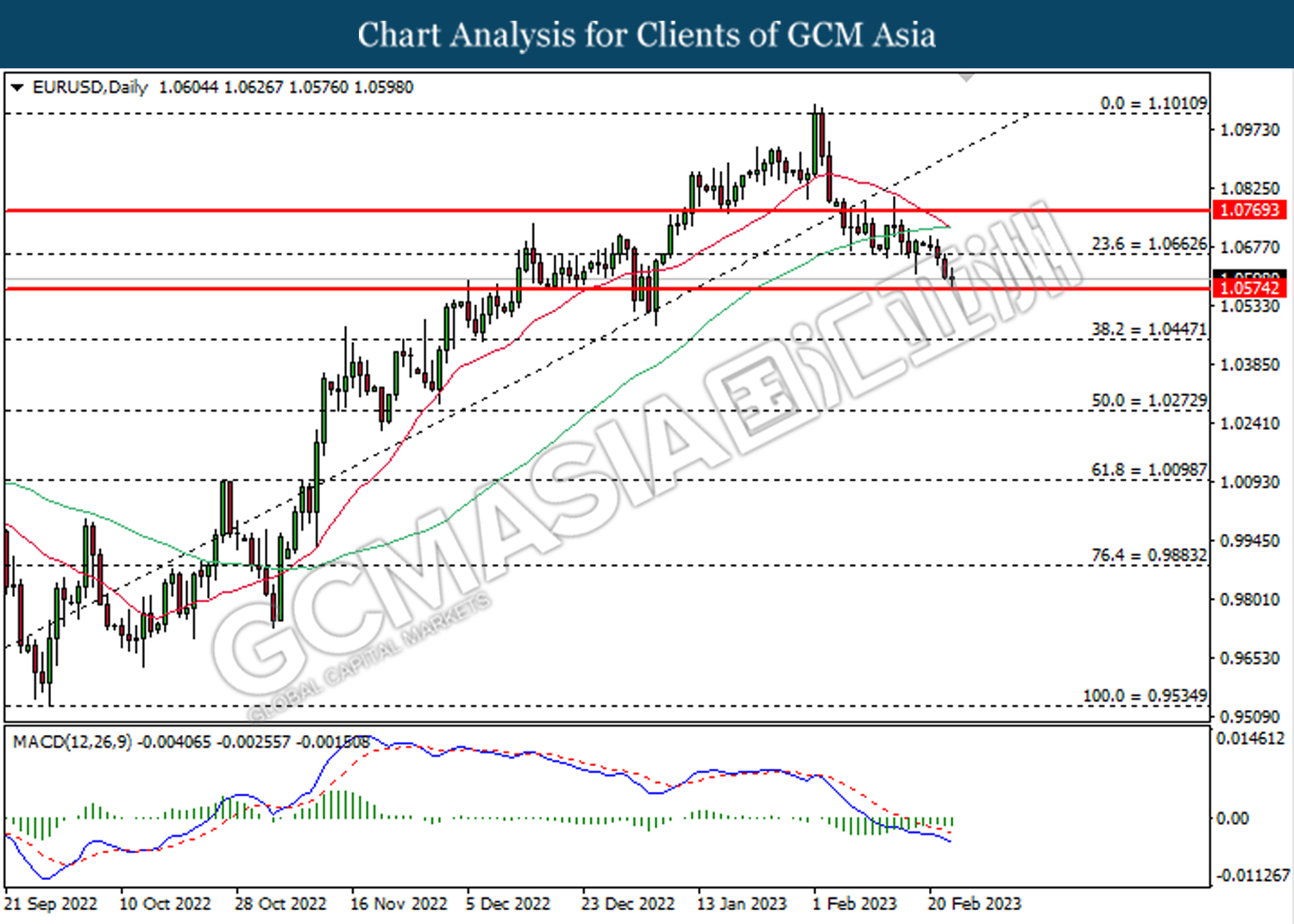

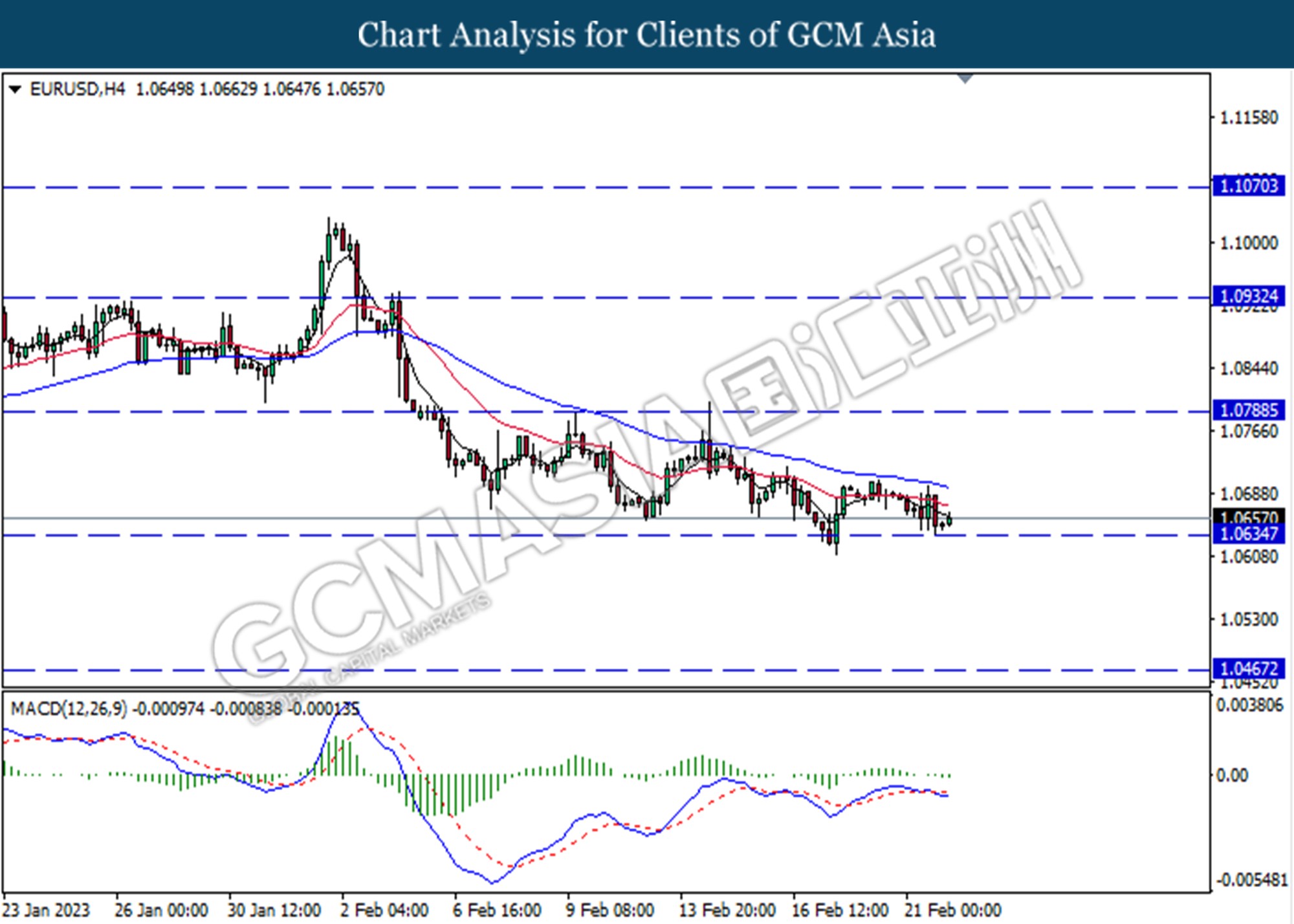

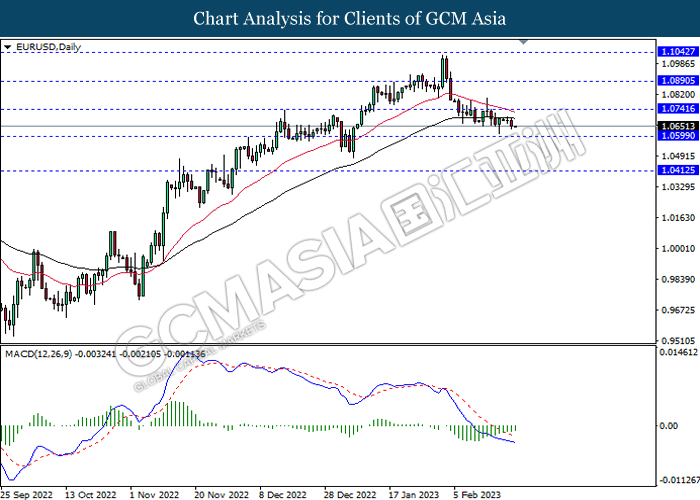

EURUSD, Daily: EURUSD was traded lower while currently retesting the support level at 1.0575. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 1.0665, 1.0770

Support level: 1.0445, 1.0275

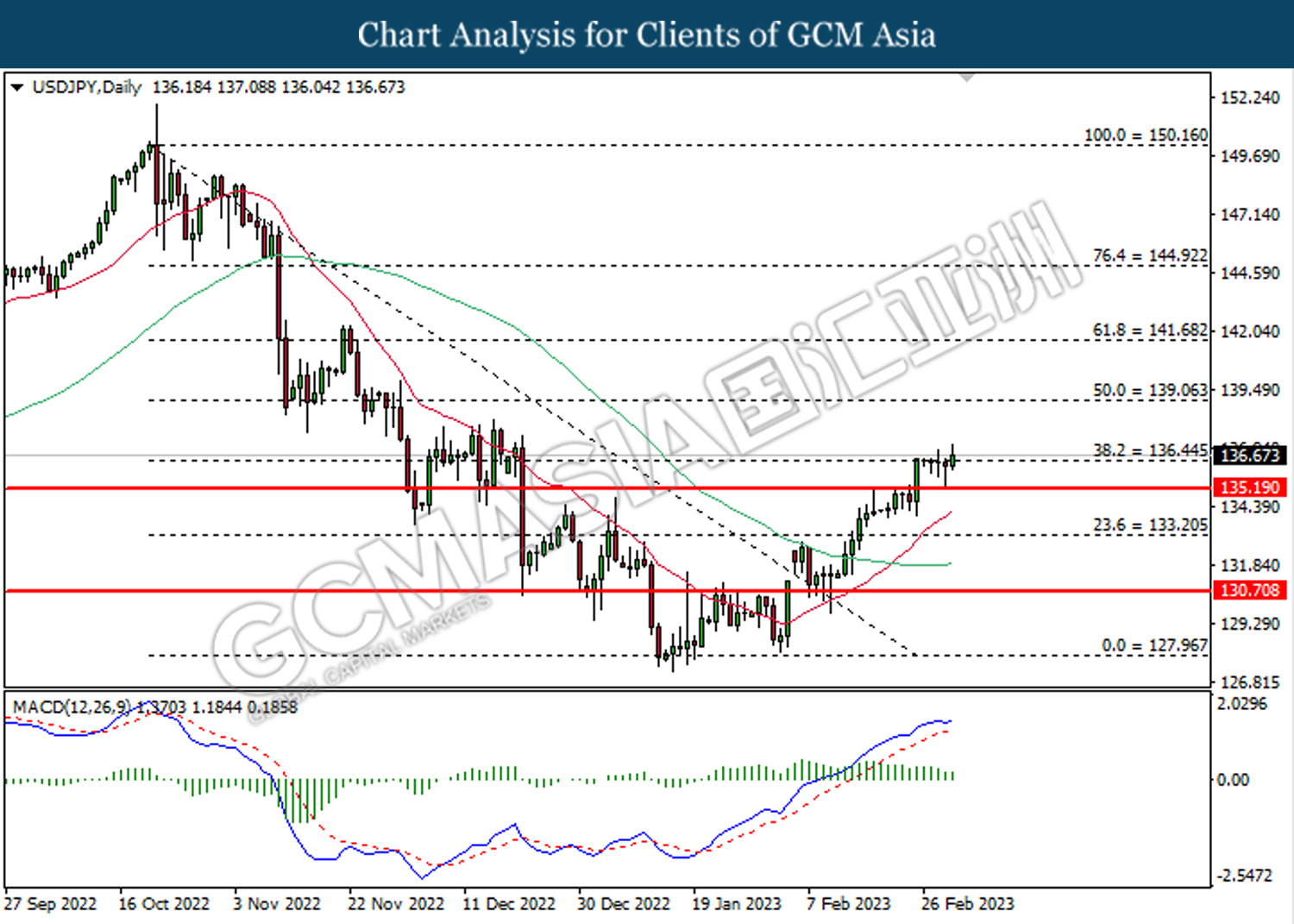

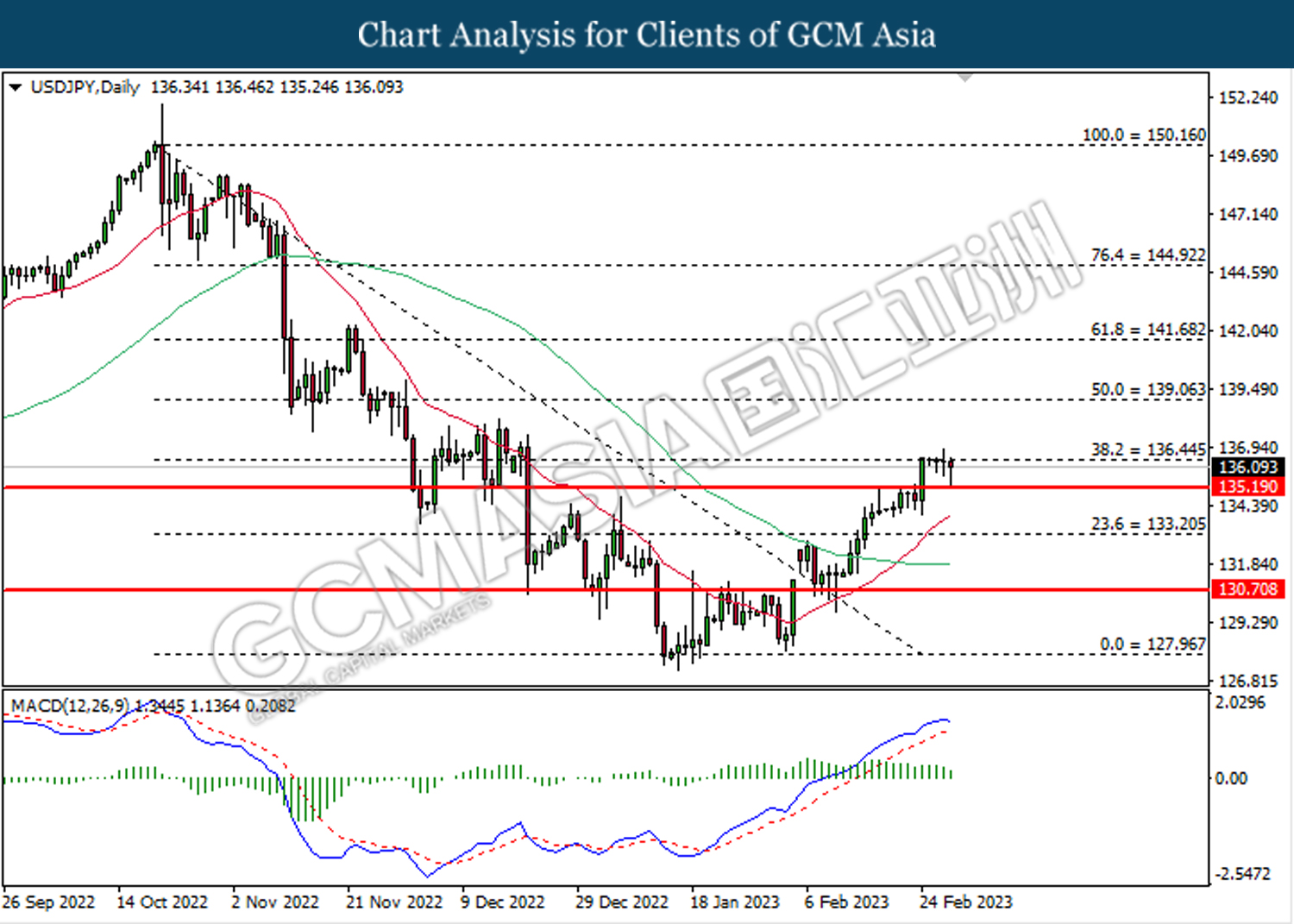

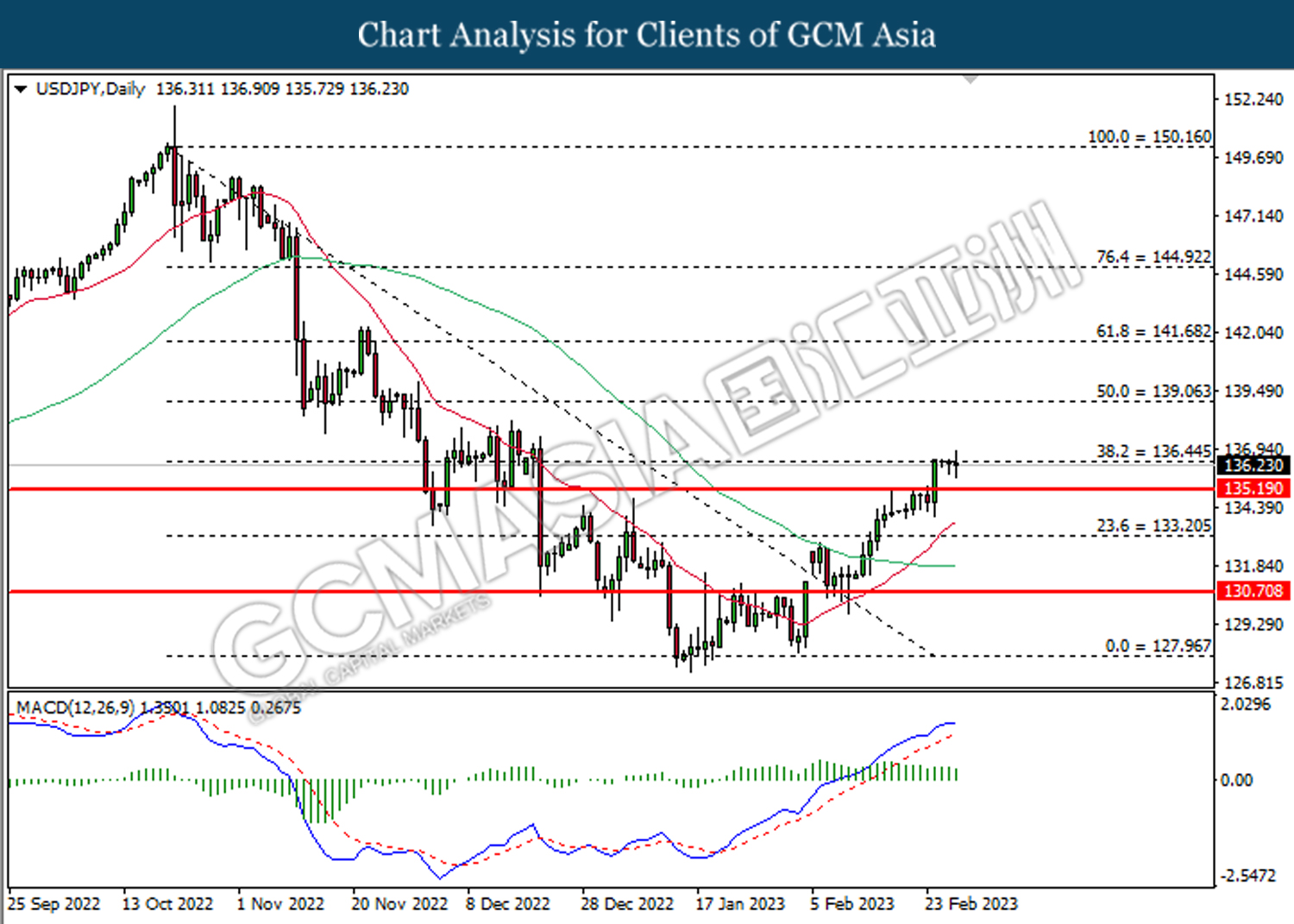

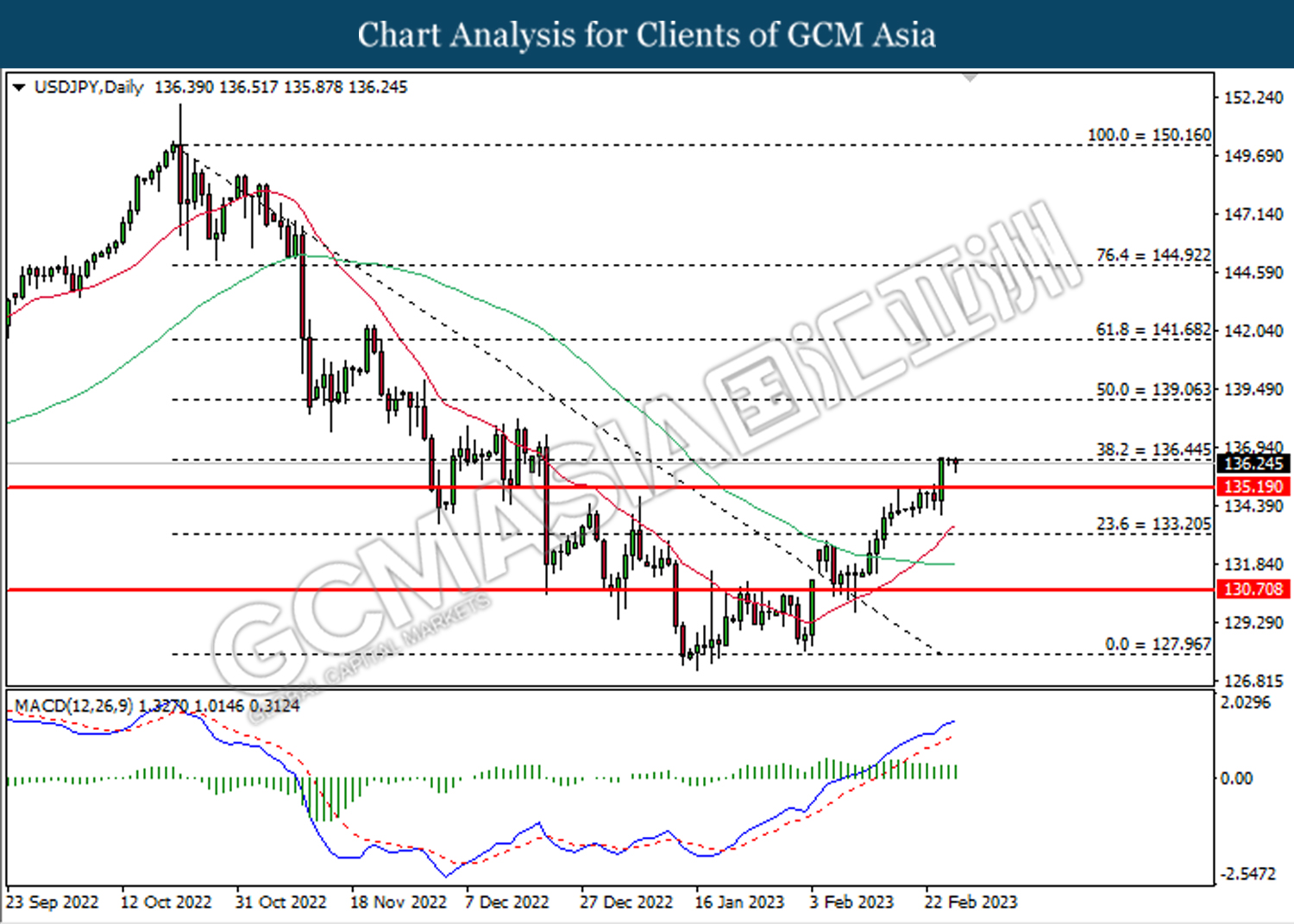

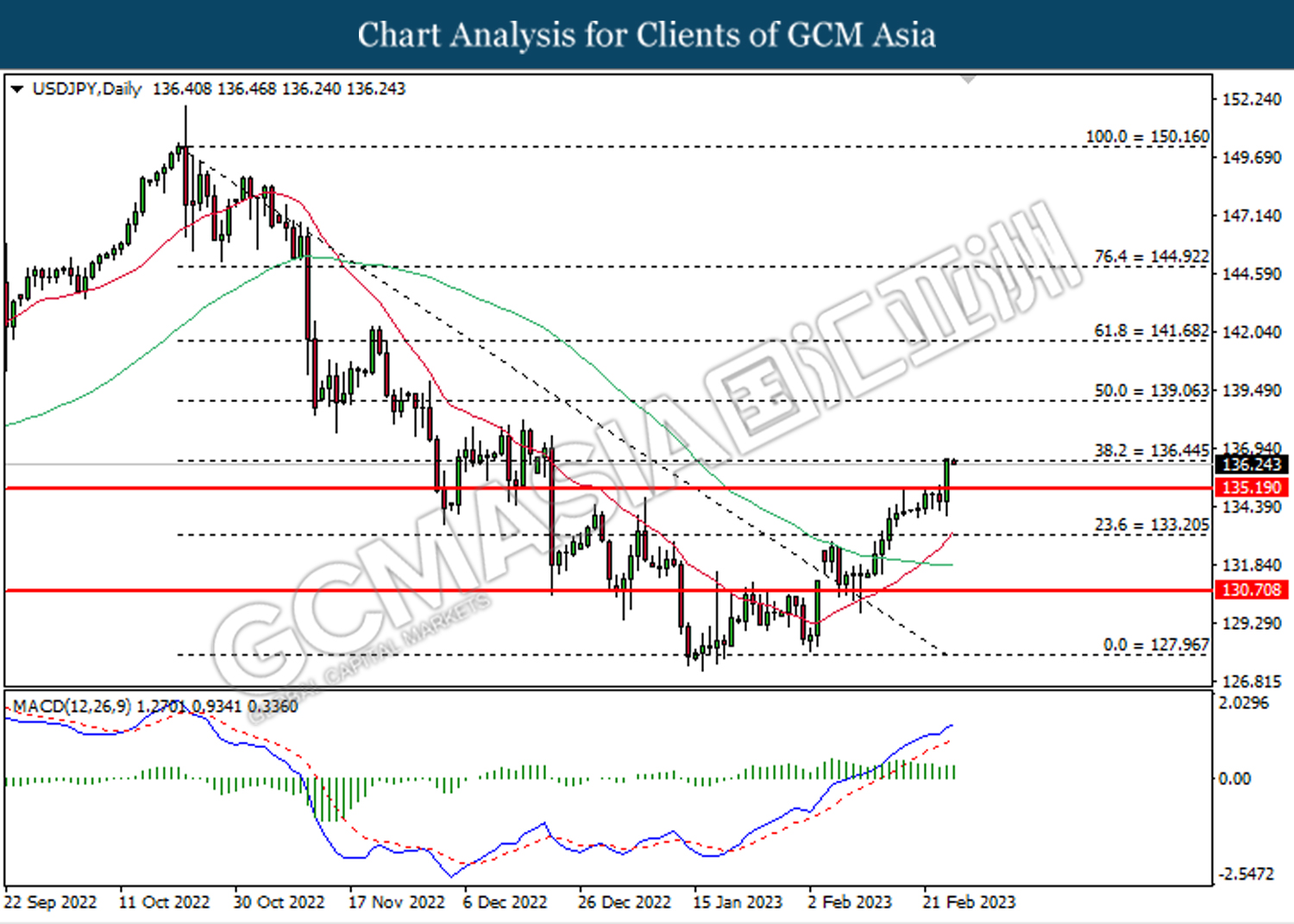

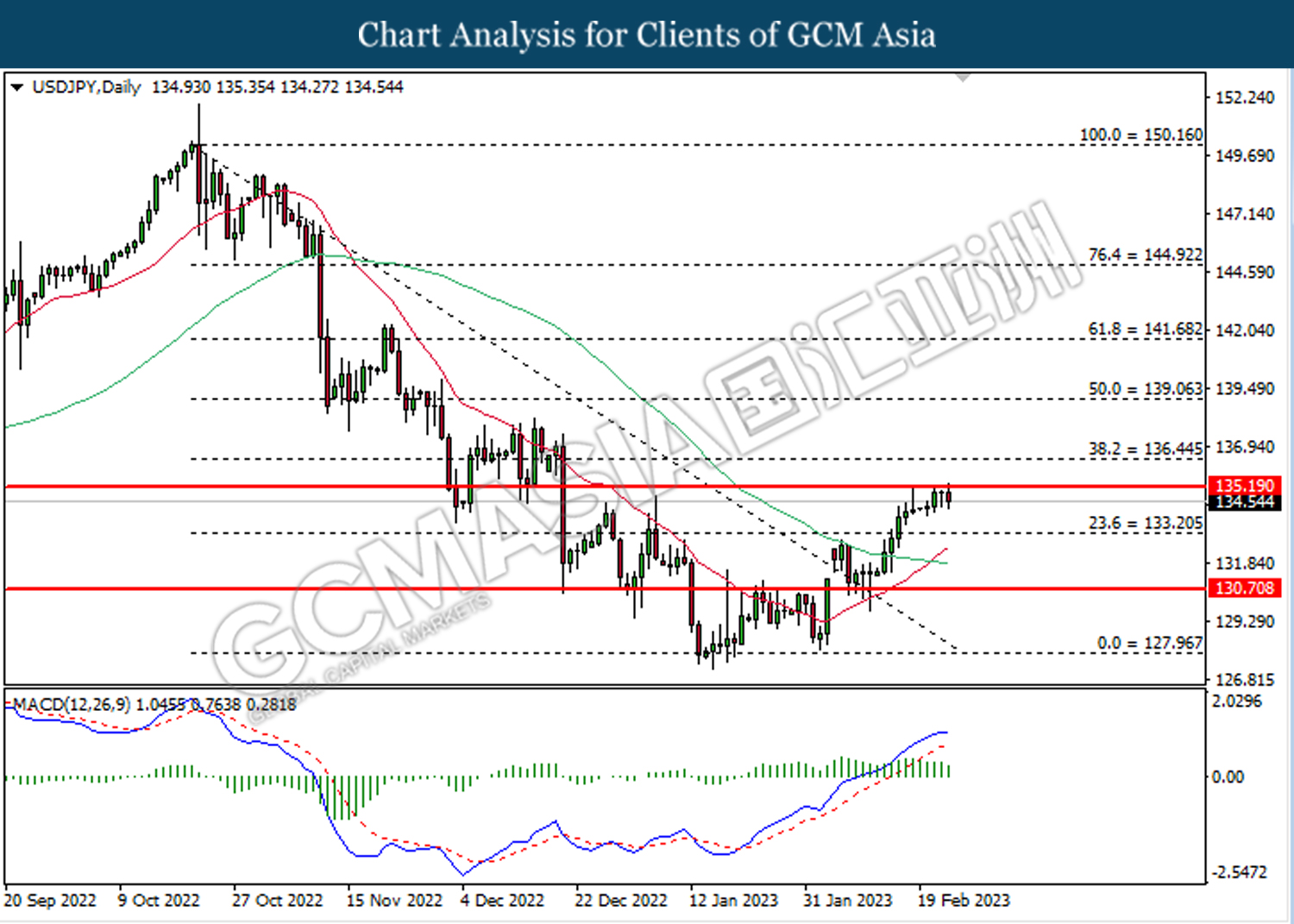

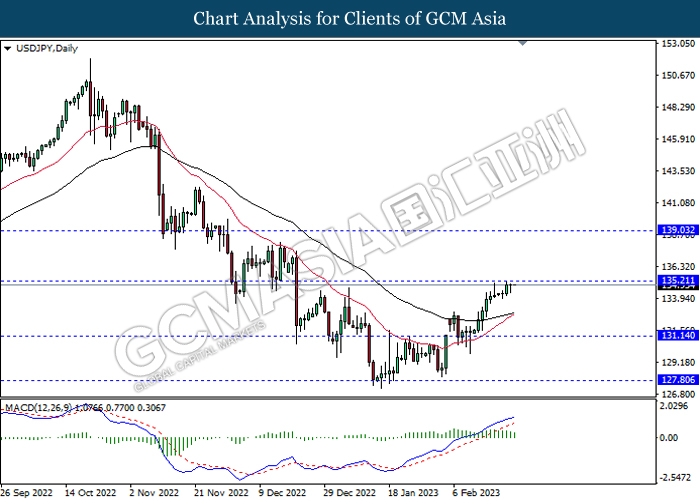

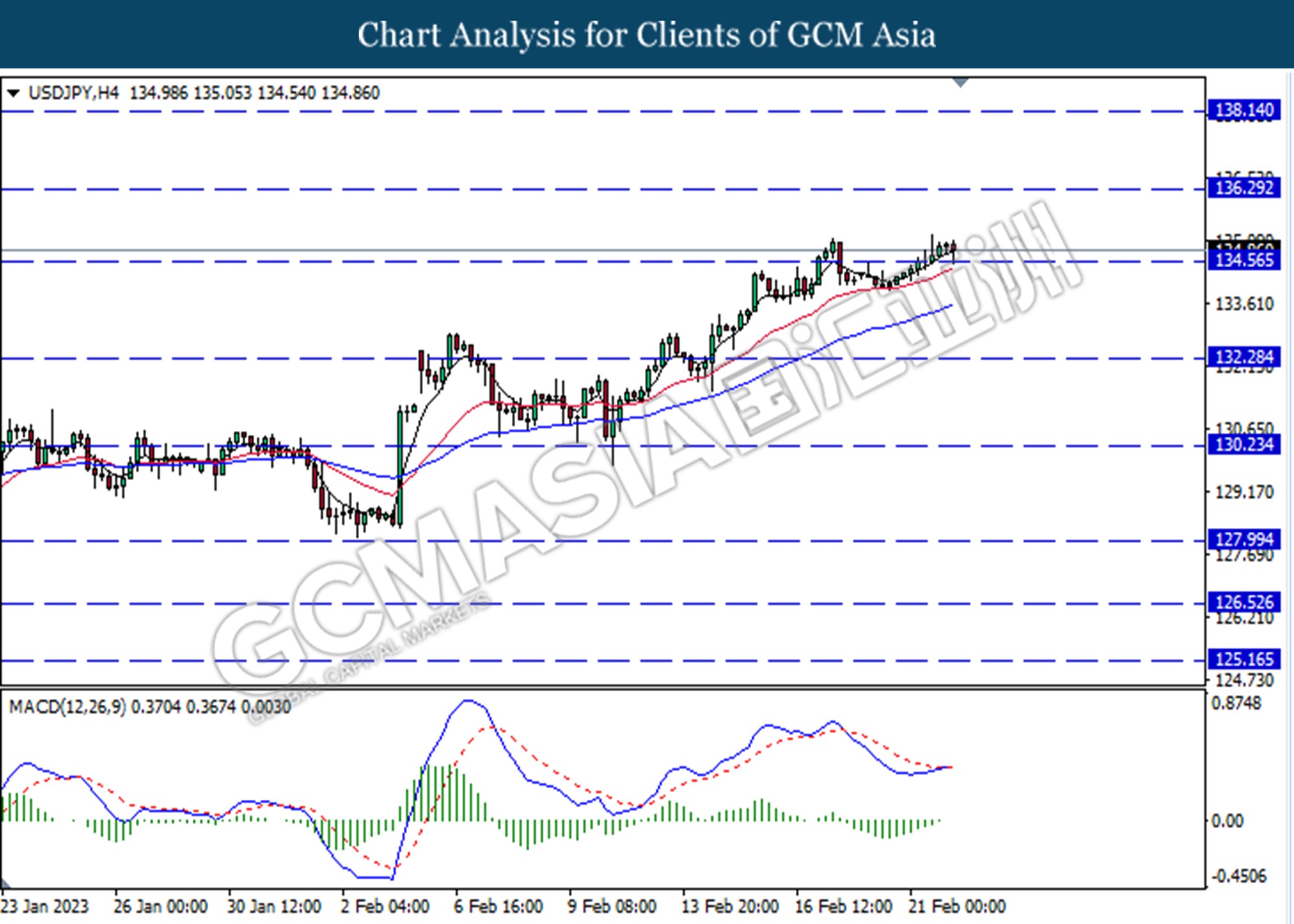

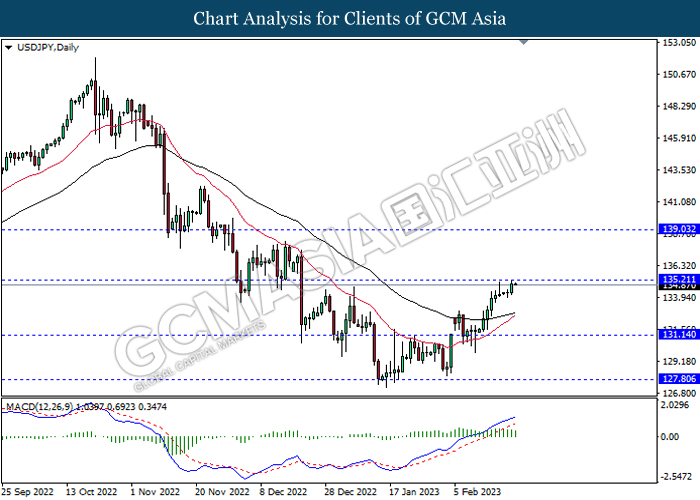

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

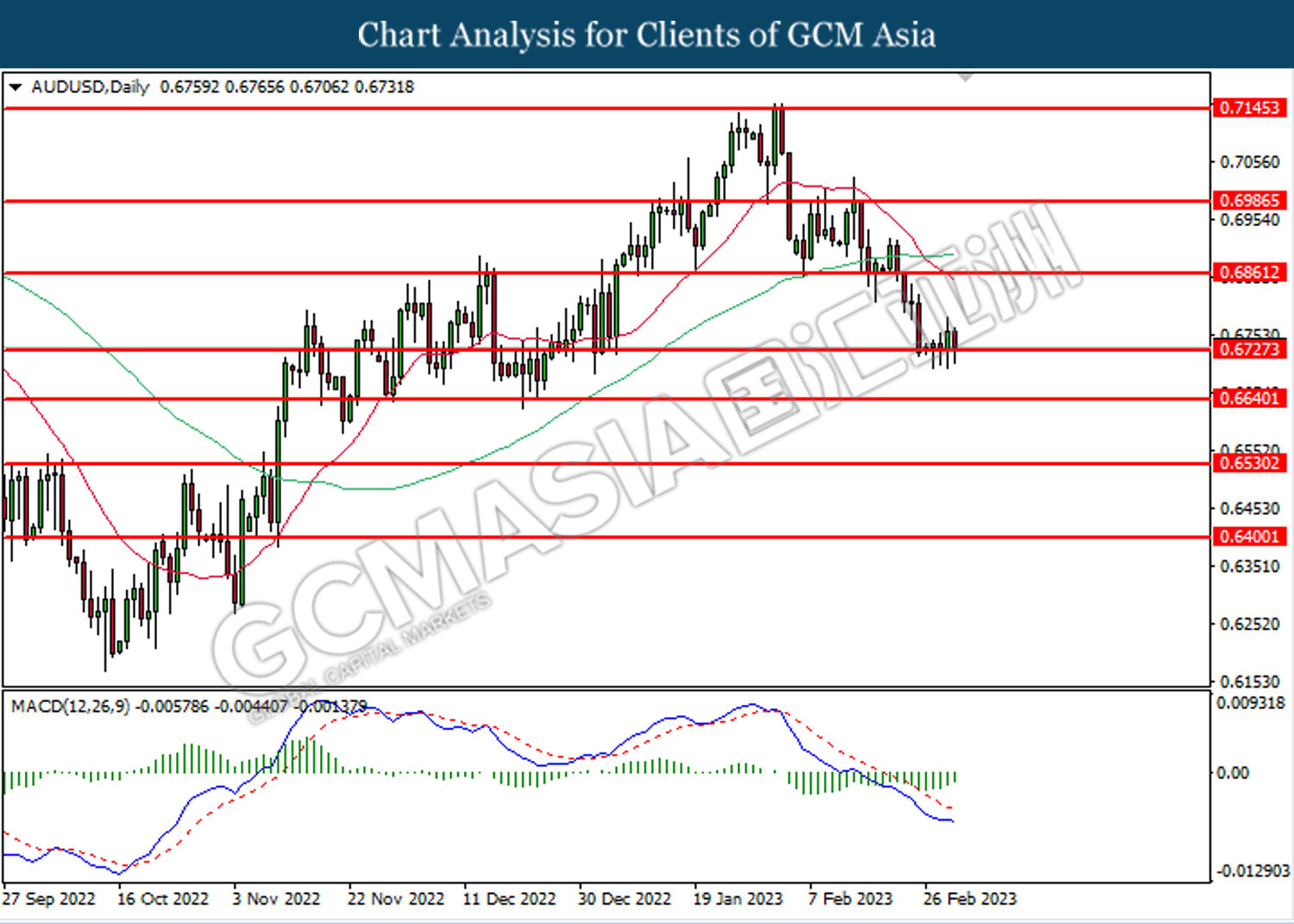

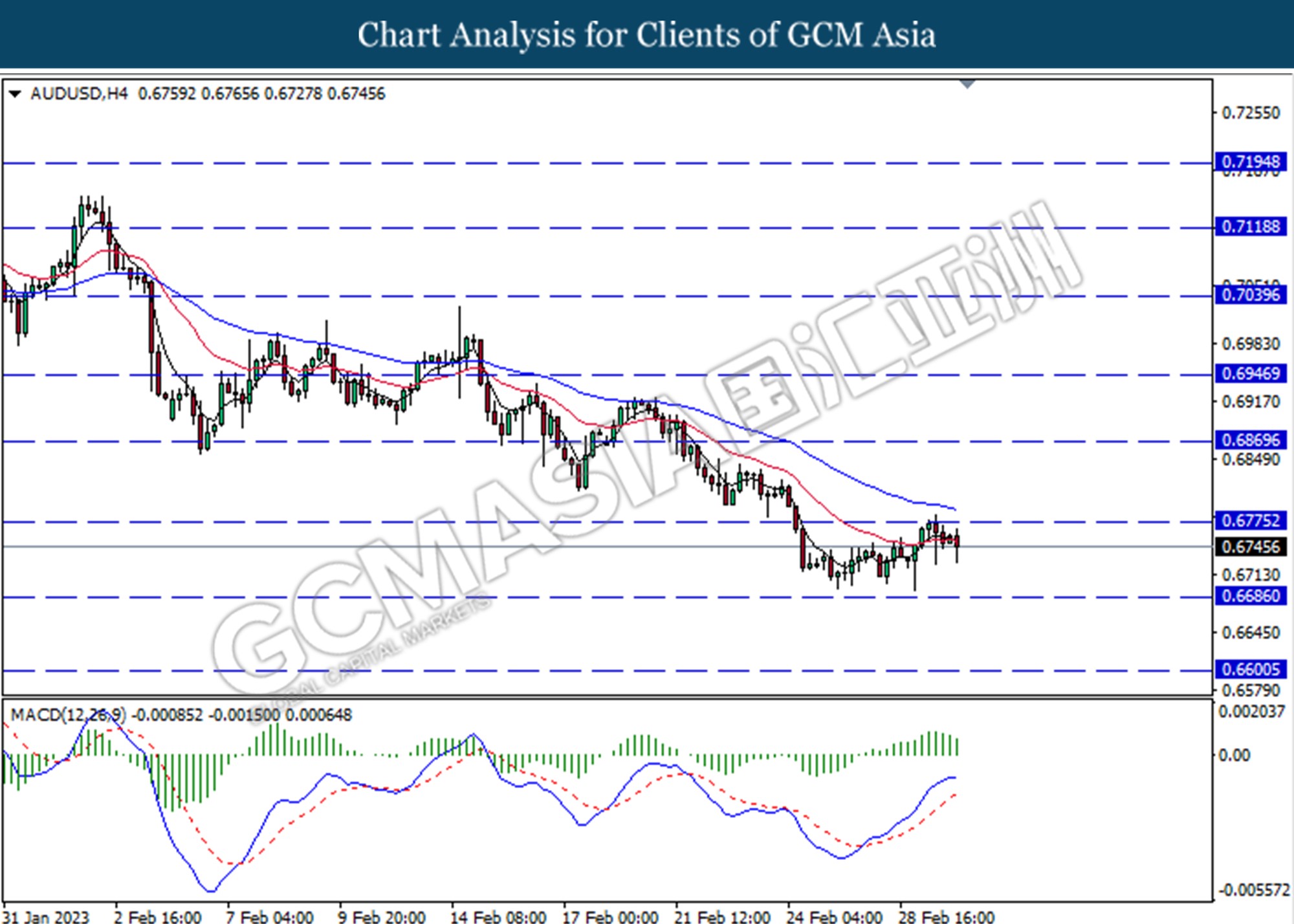

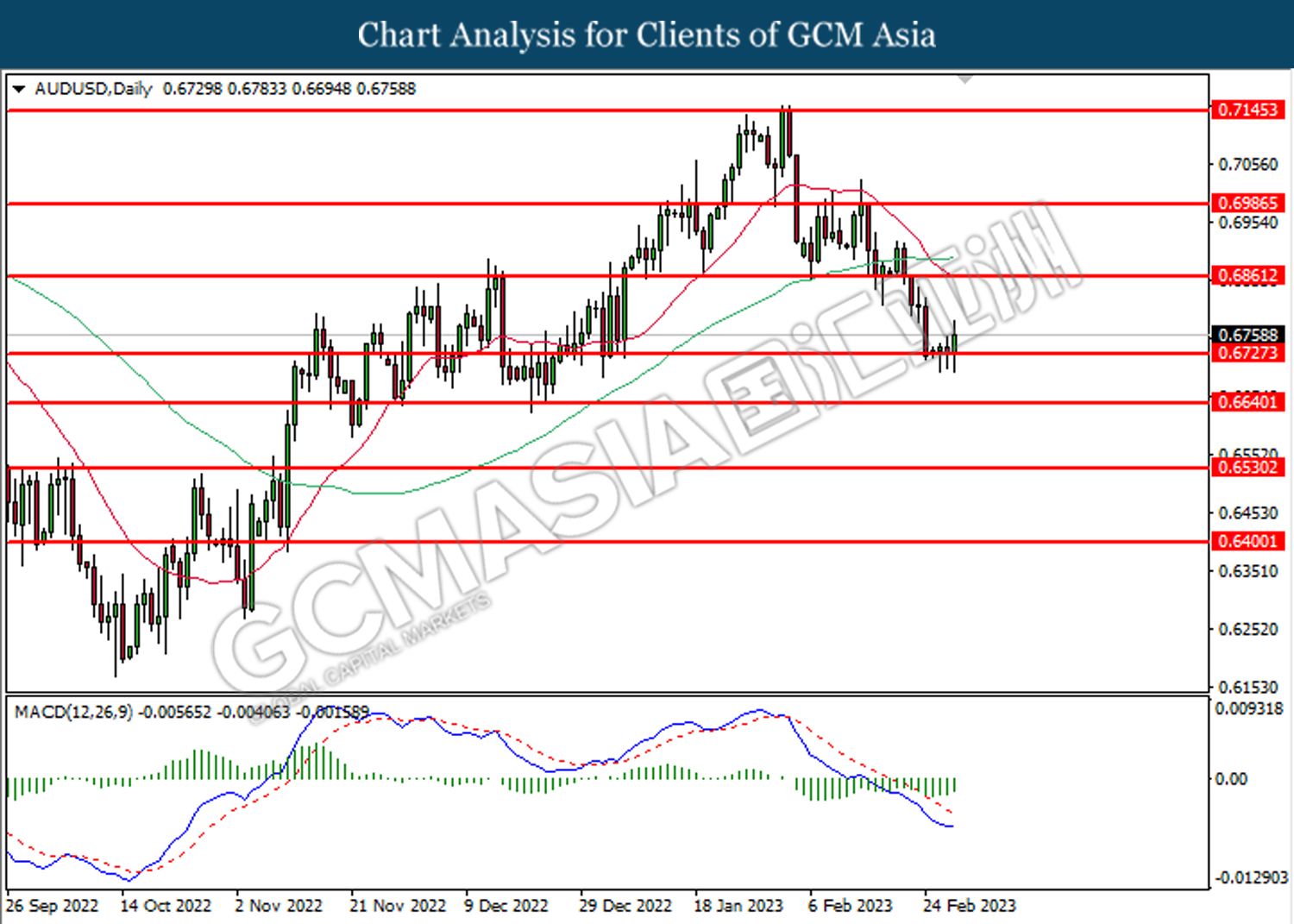

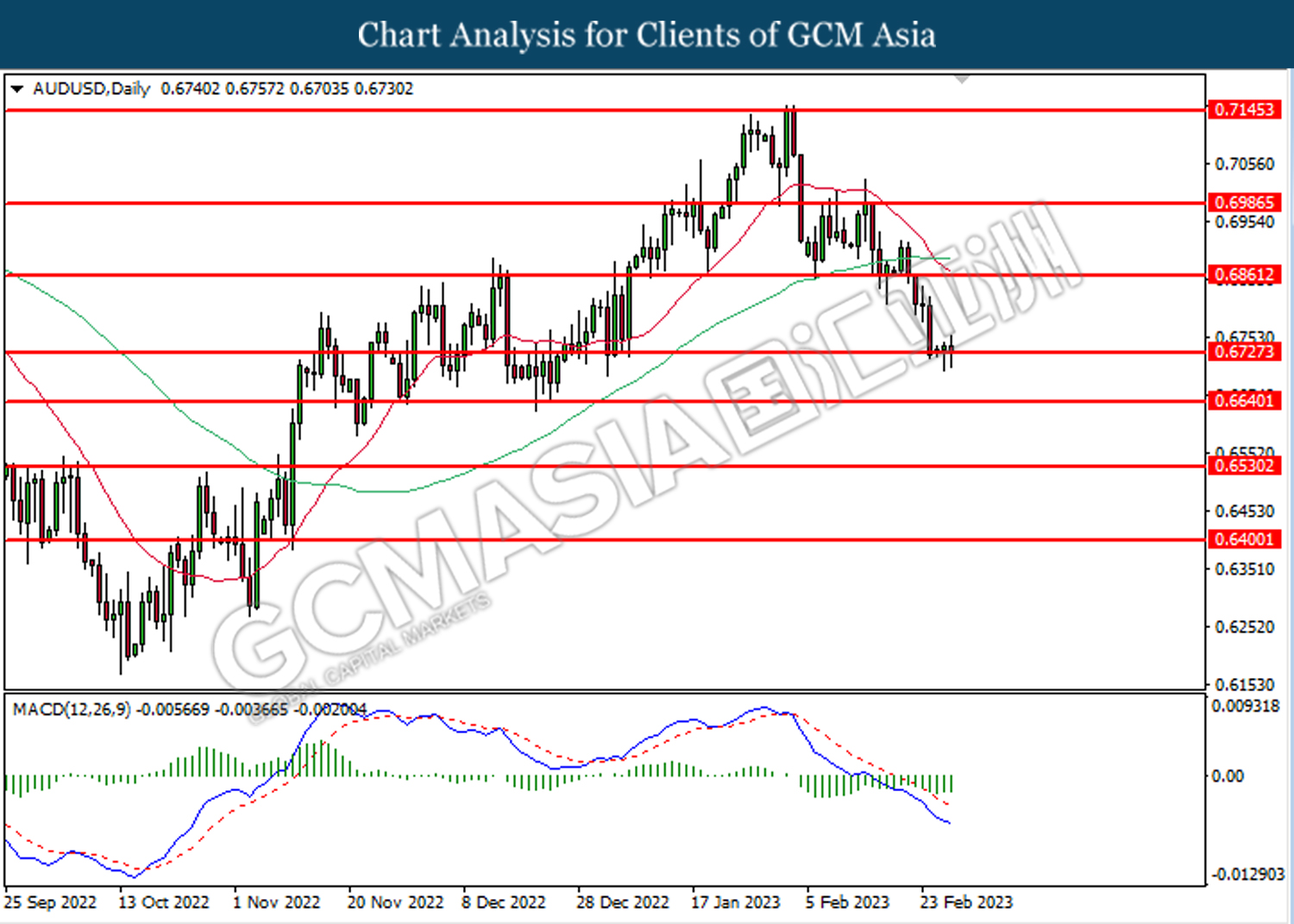

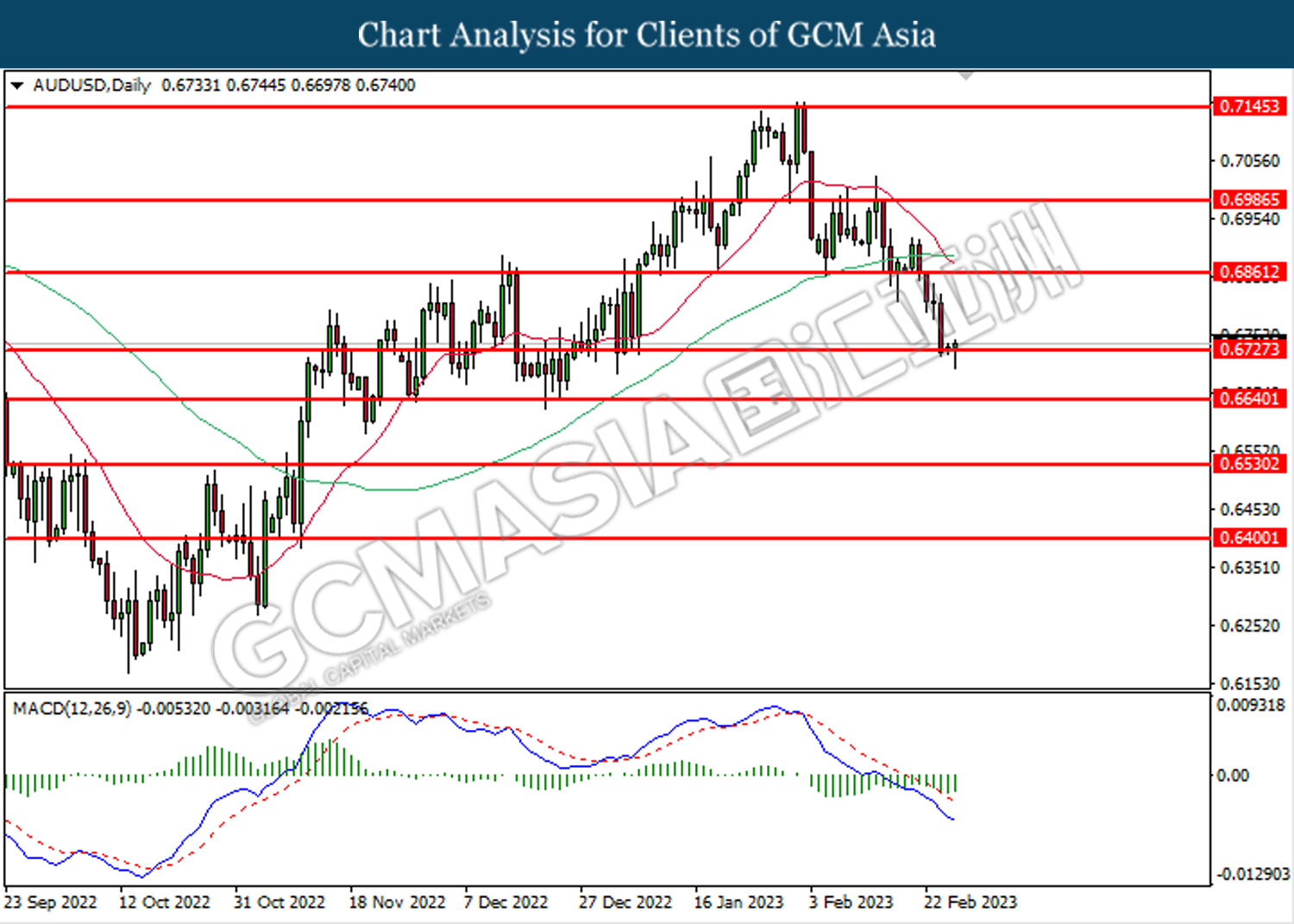

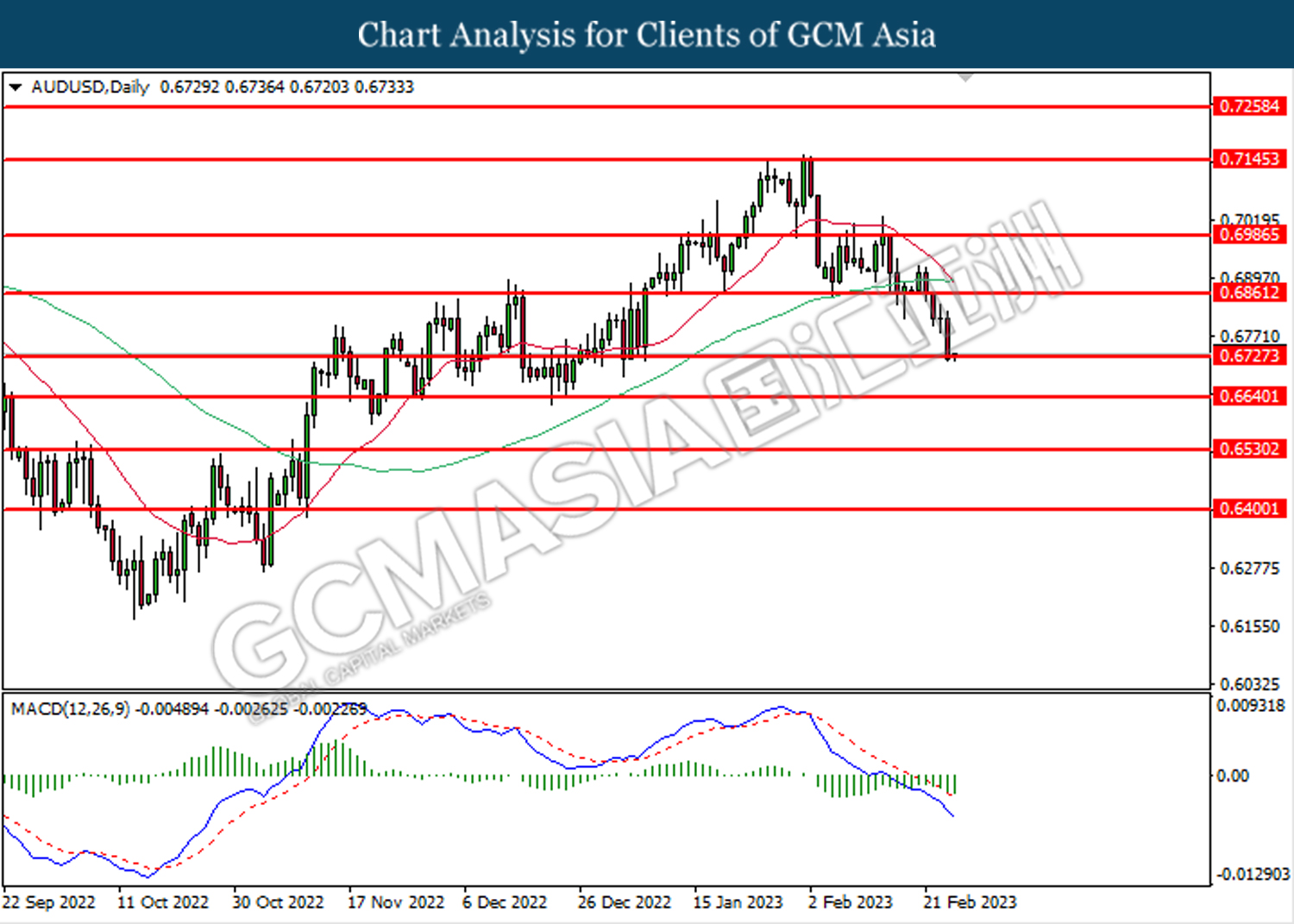

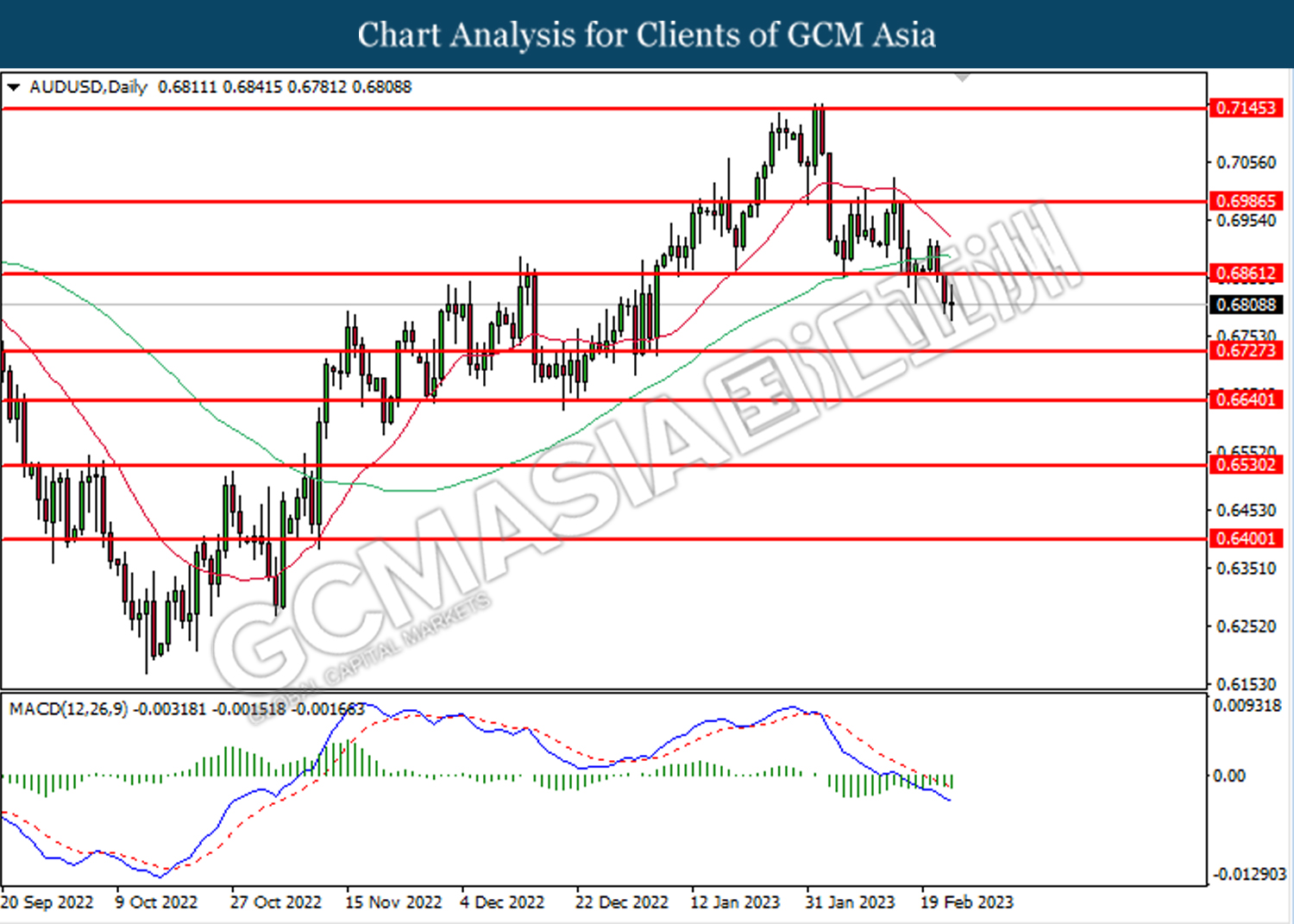

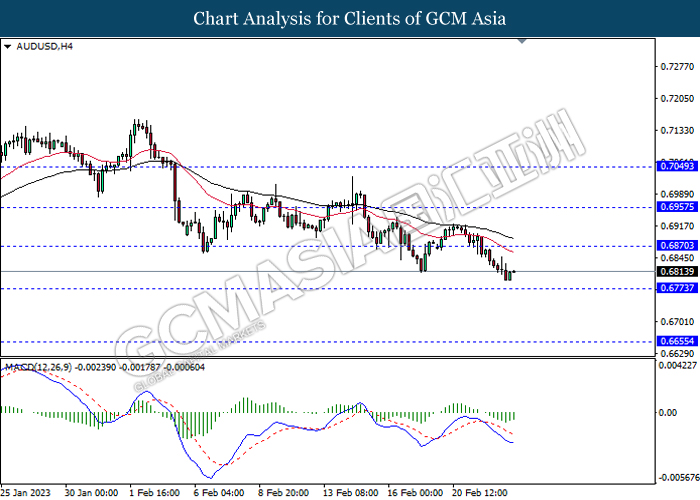

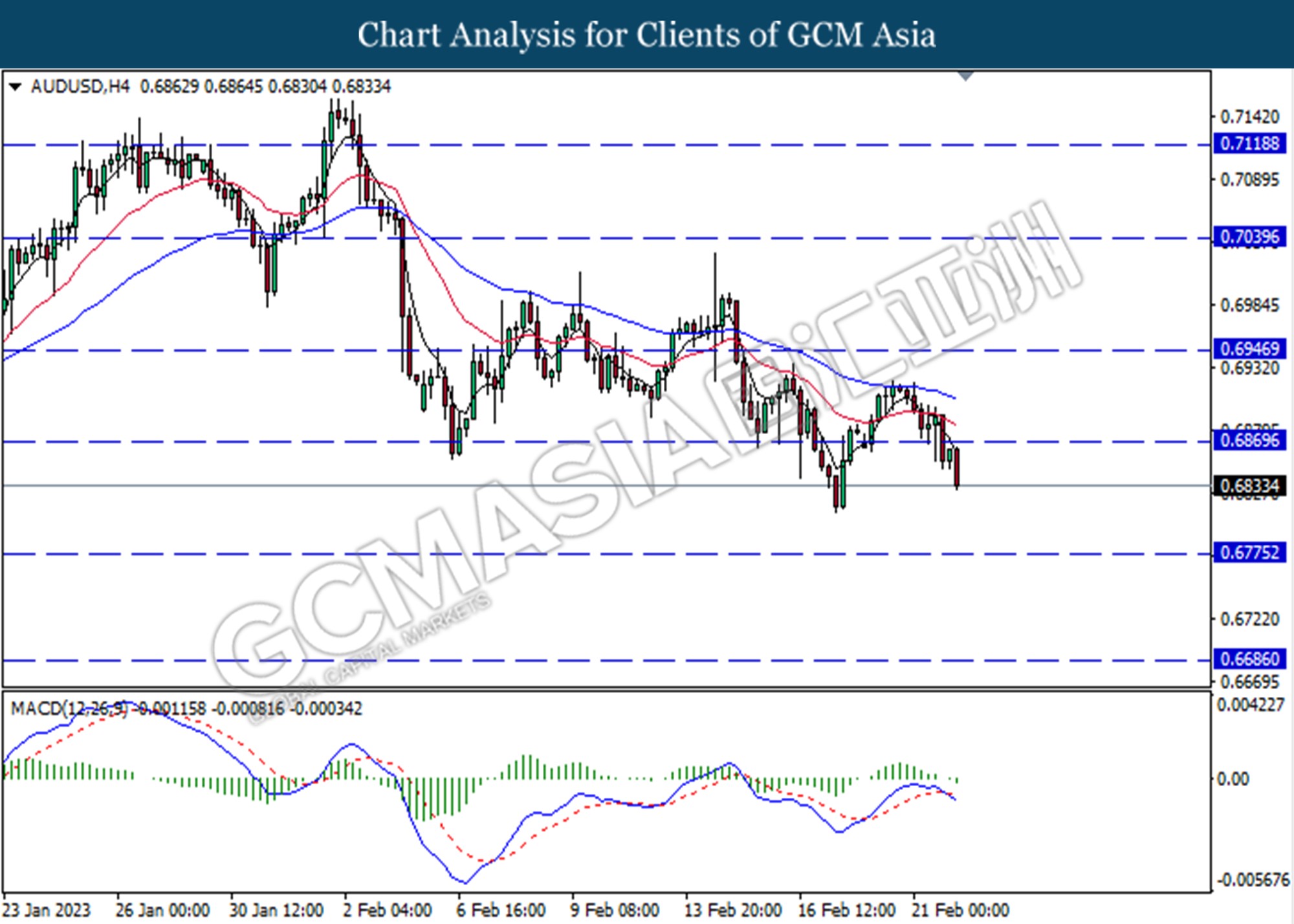

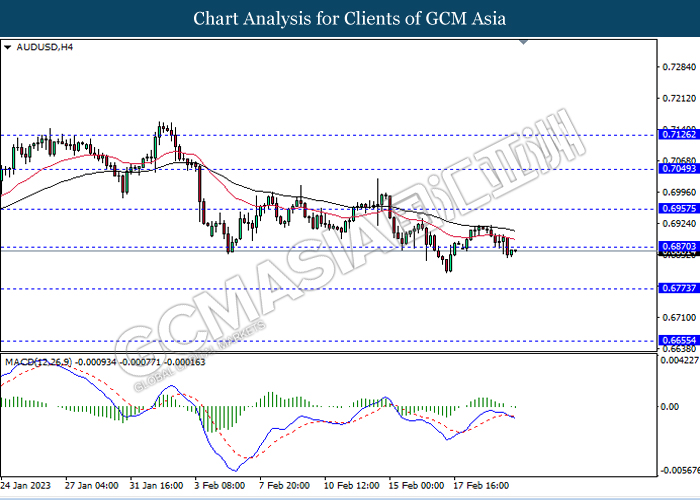

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

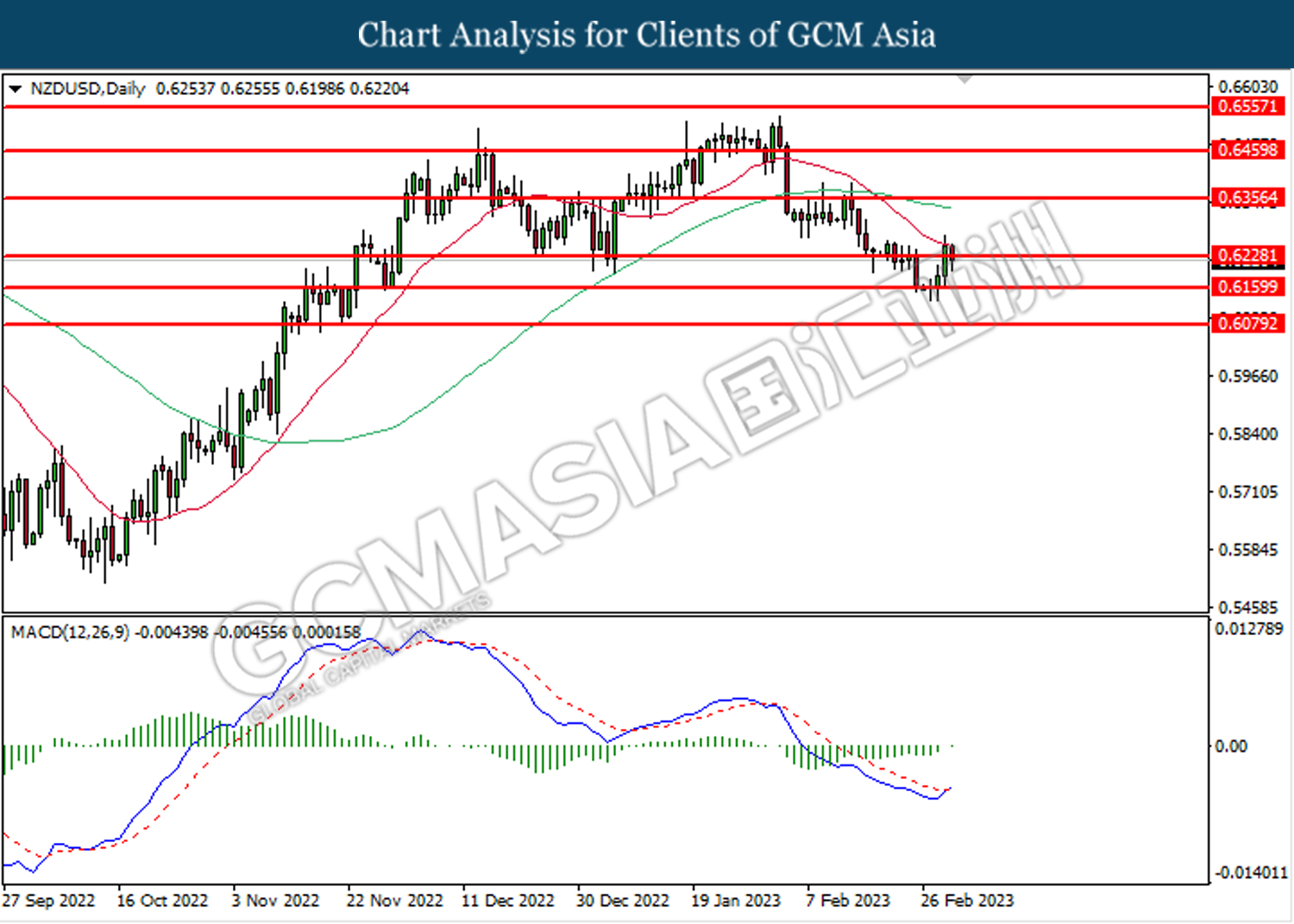

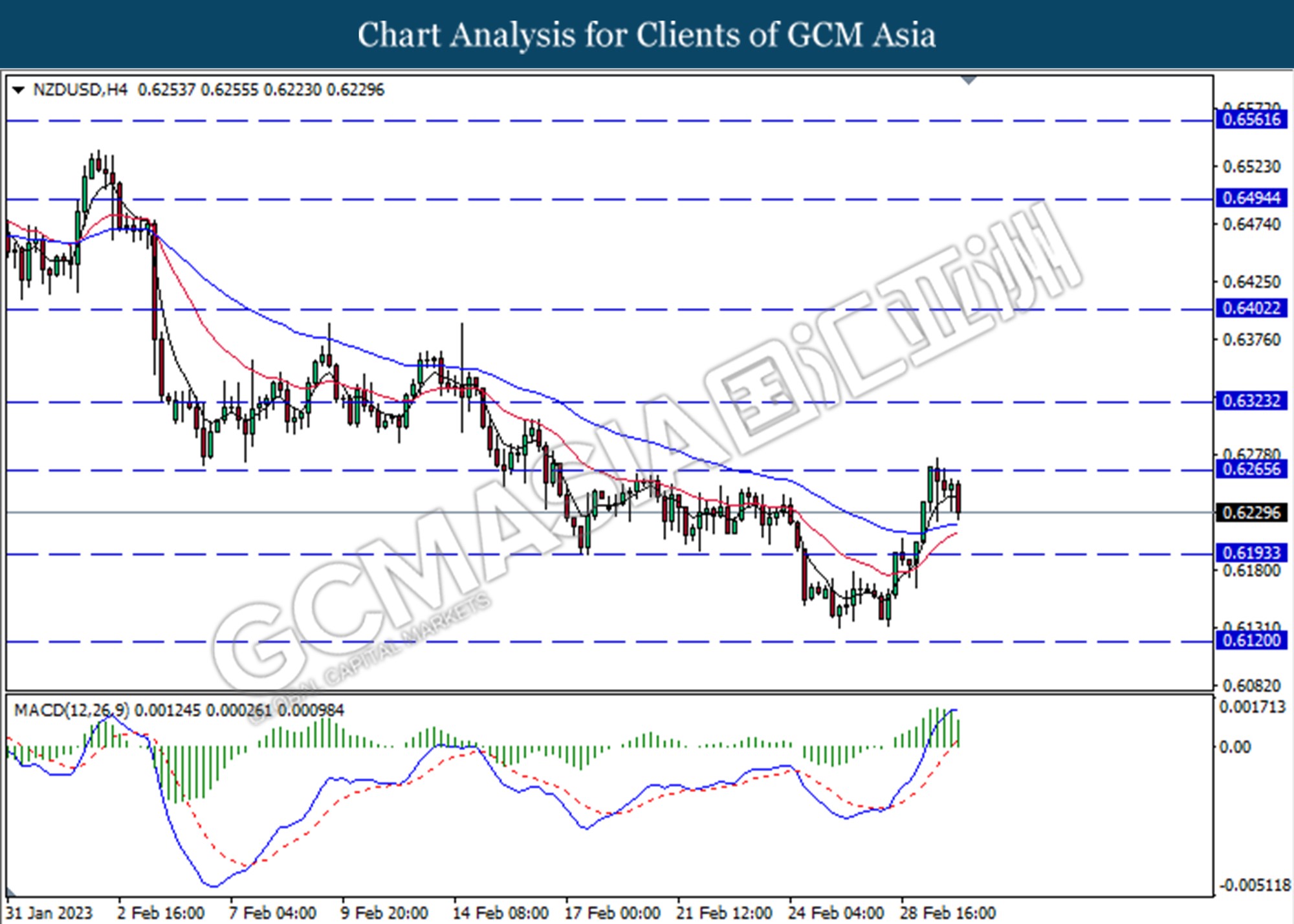

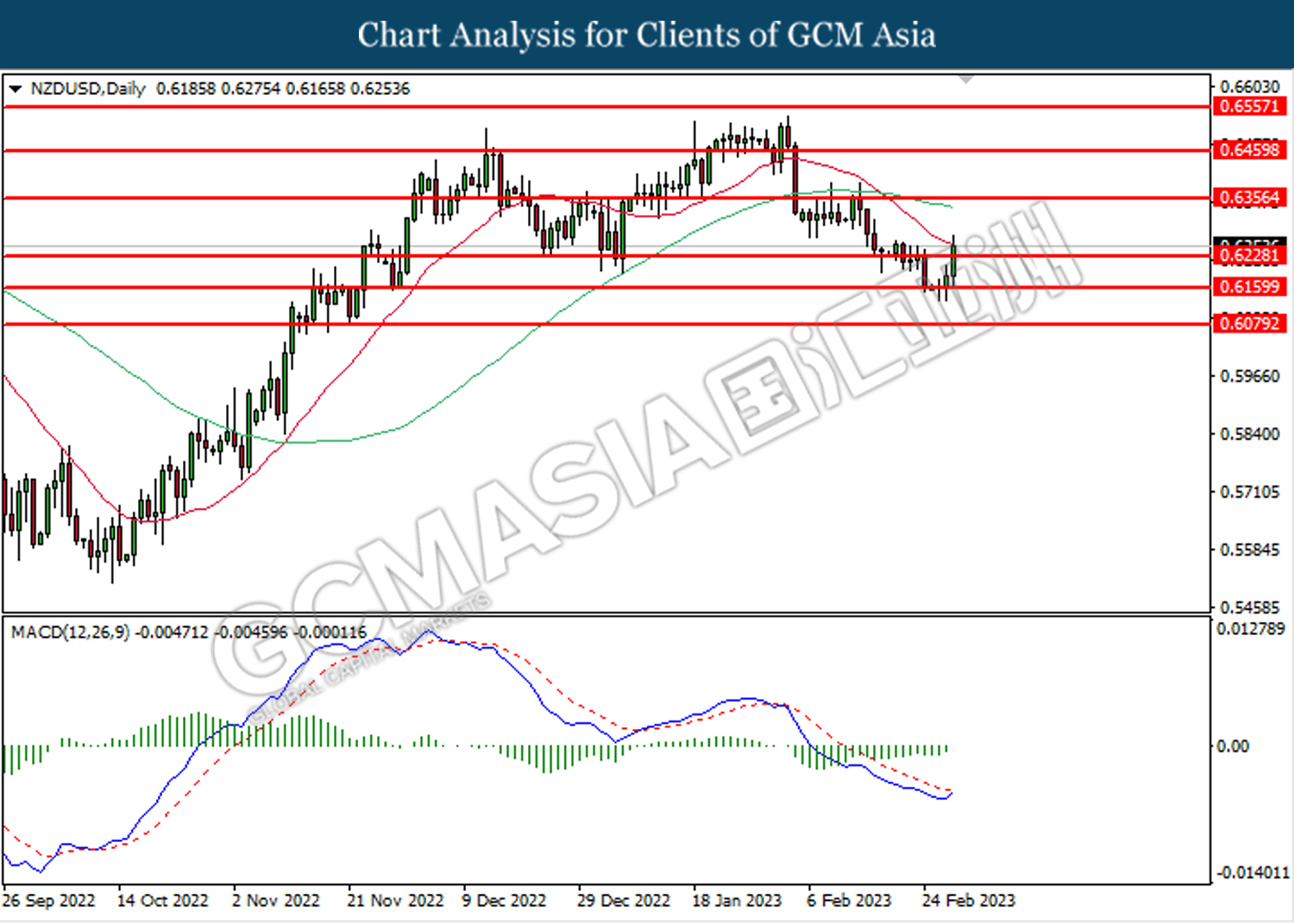

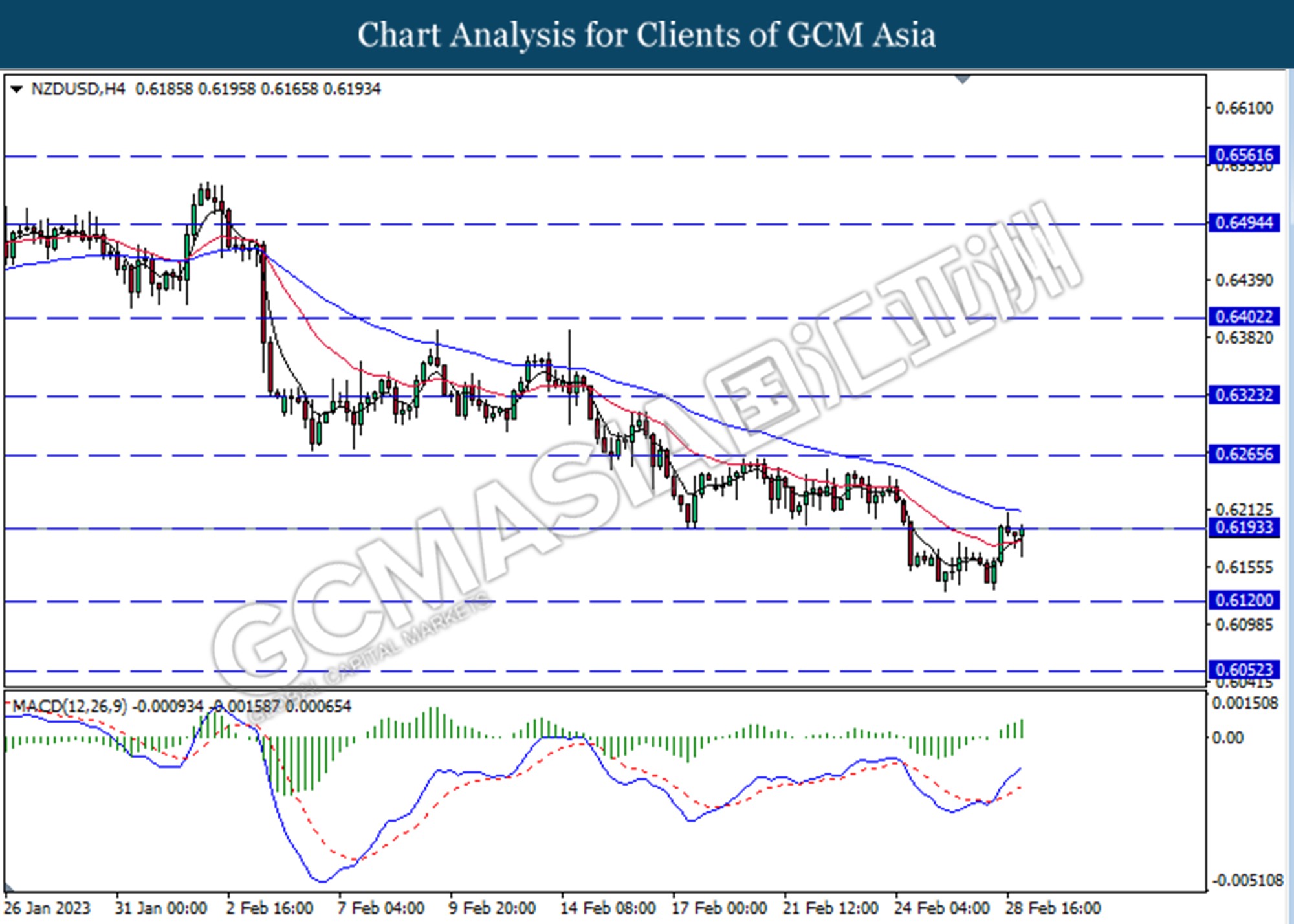

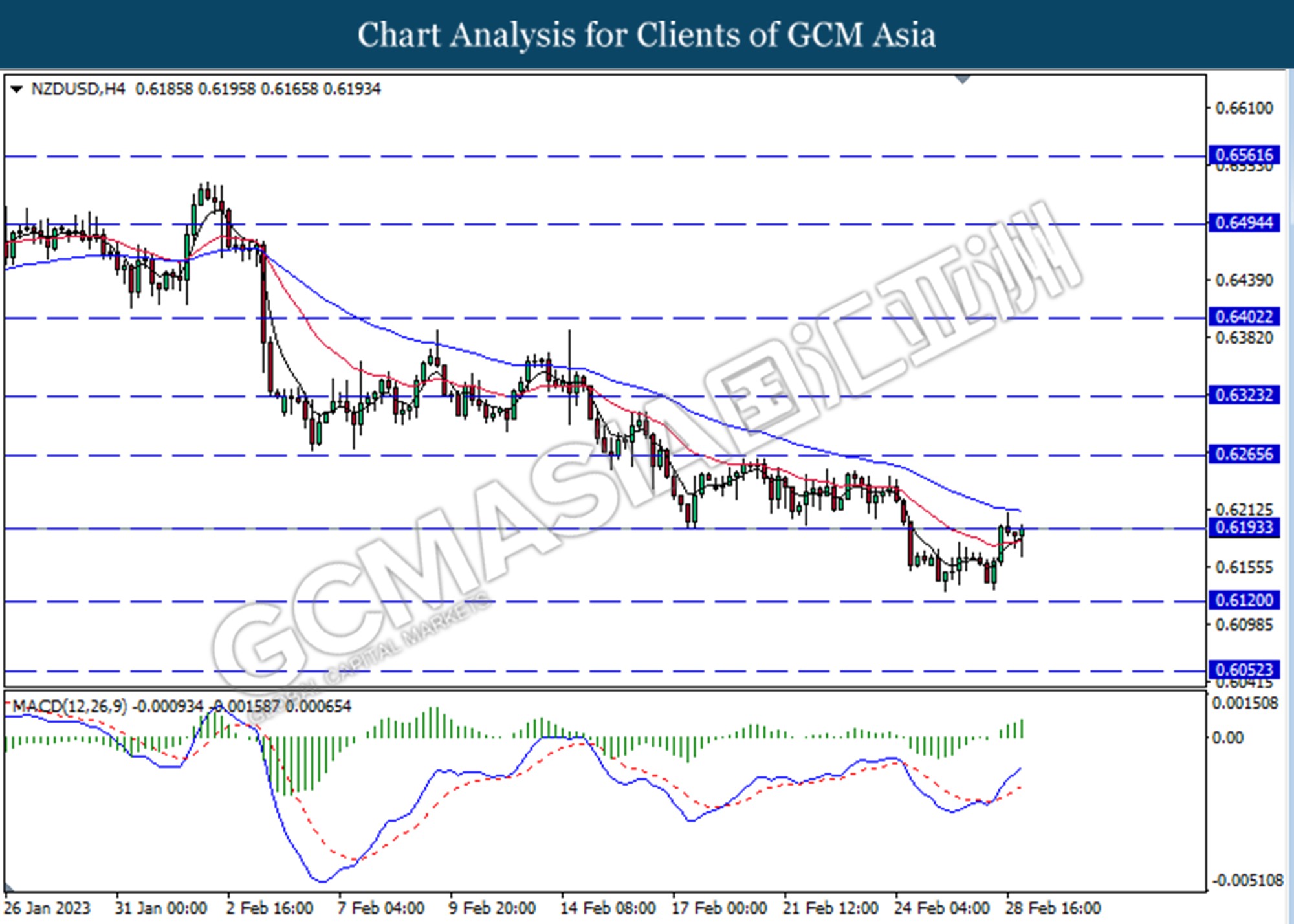

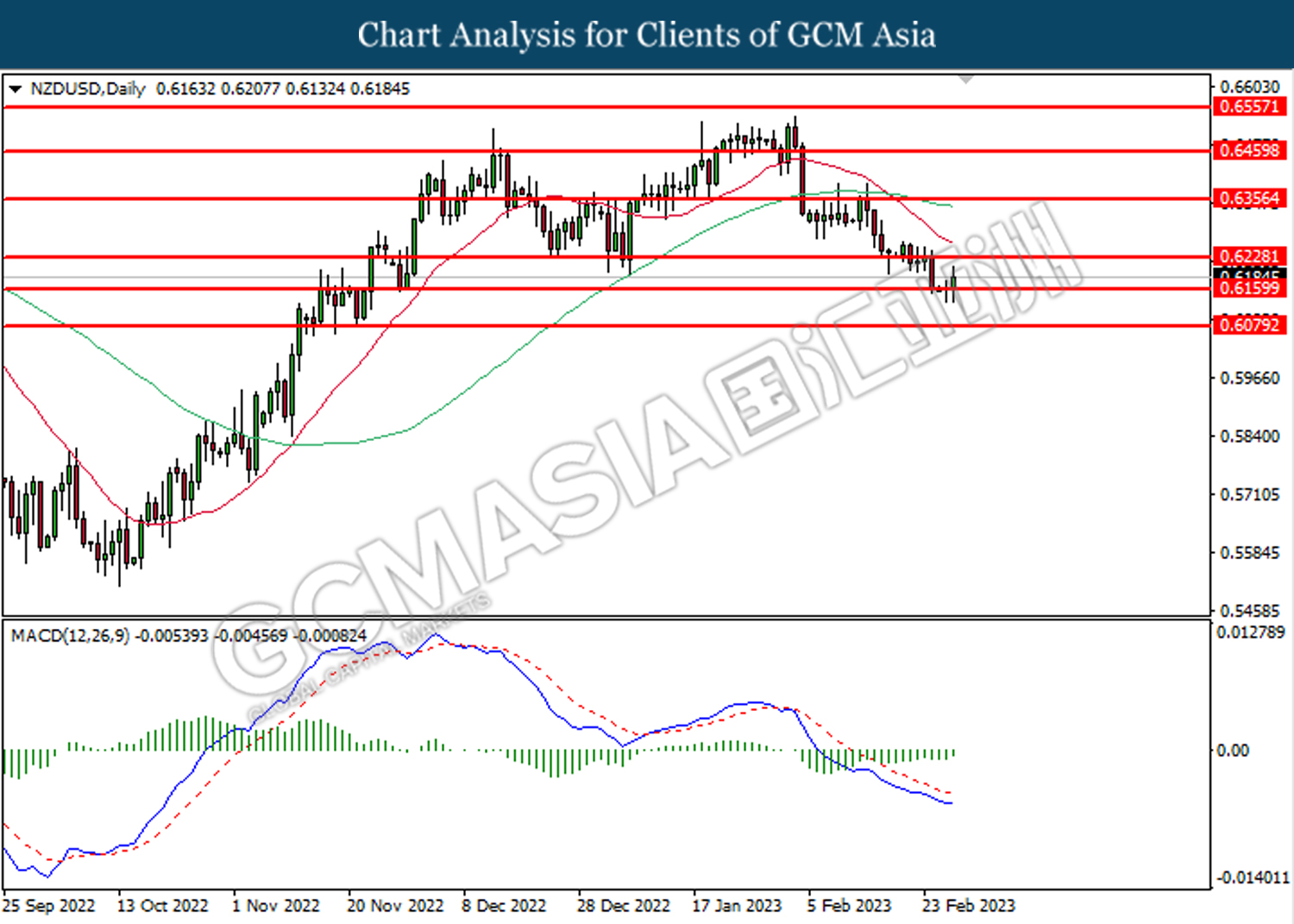

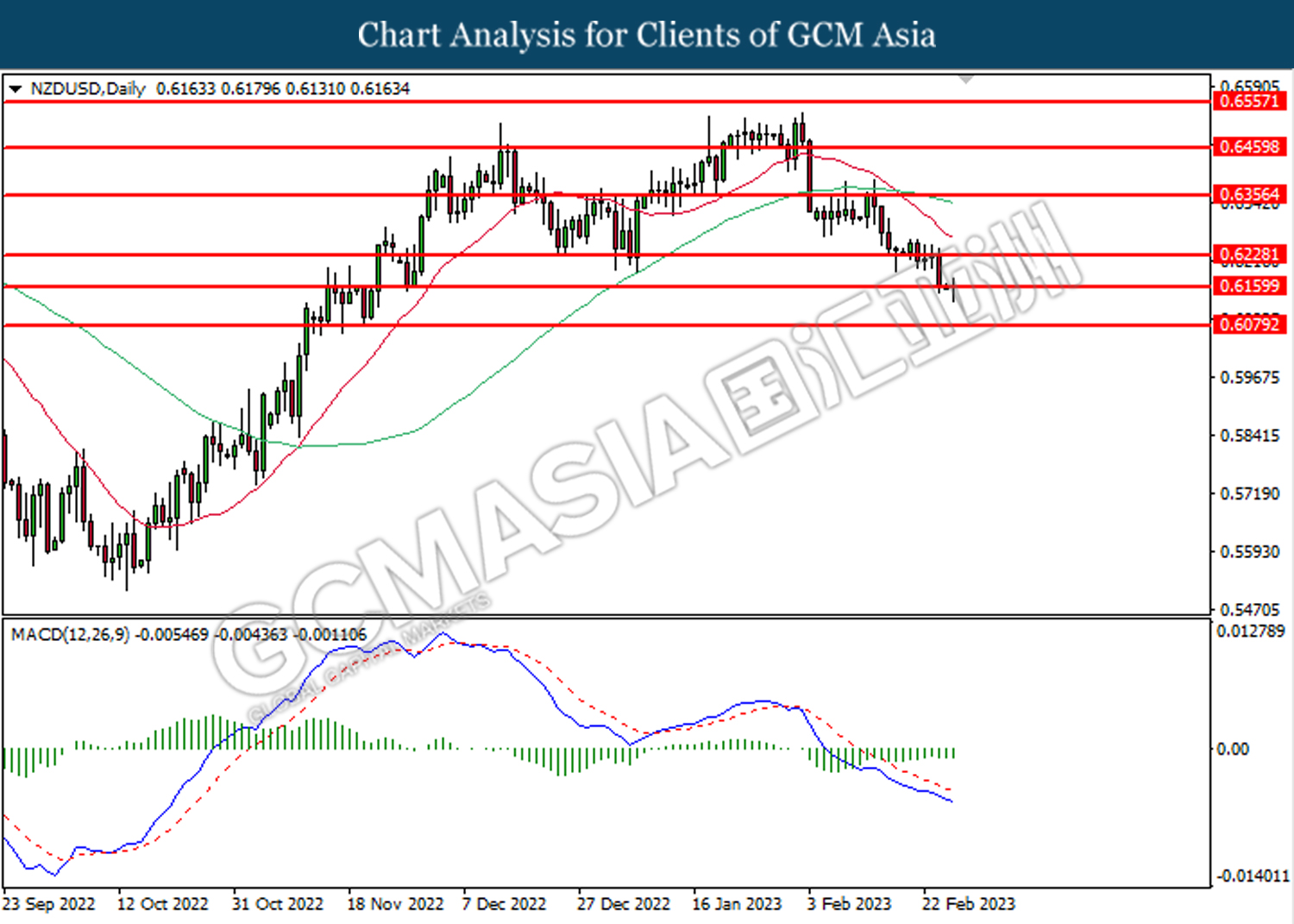

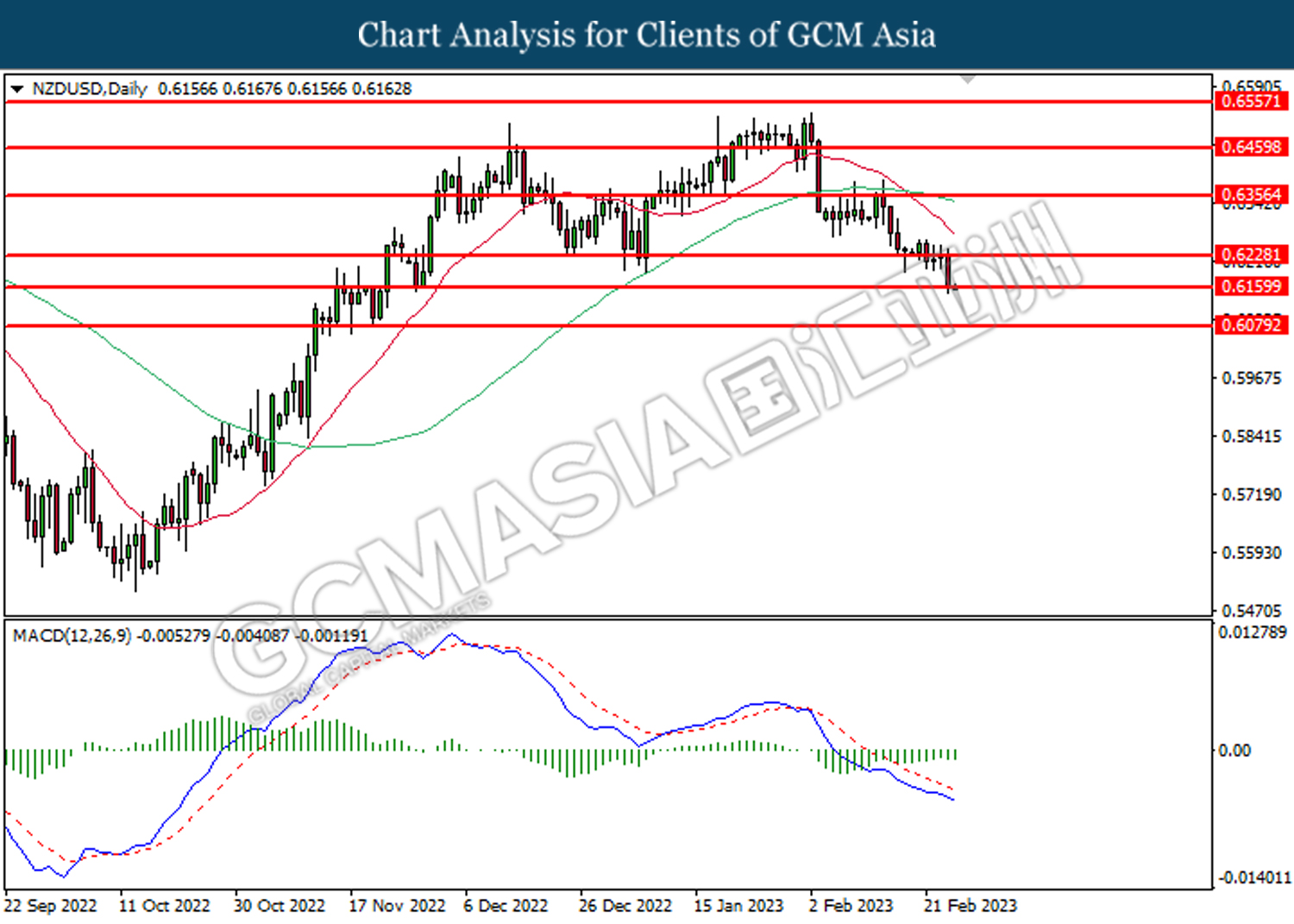

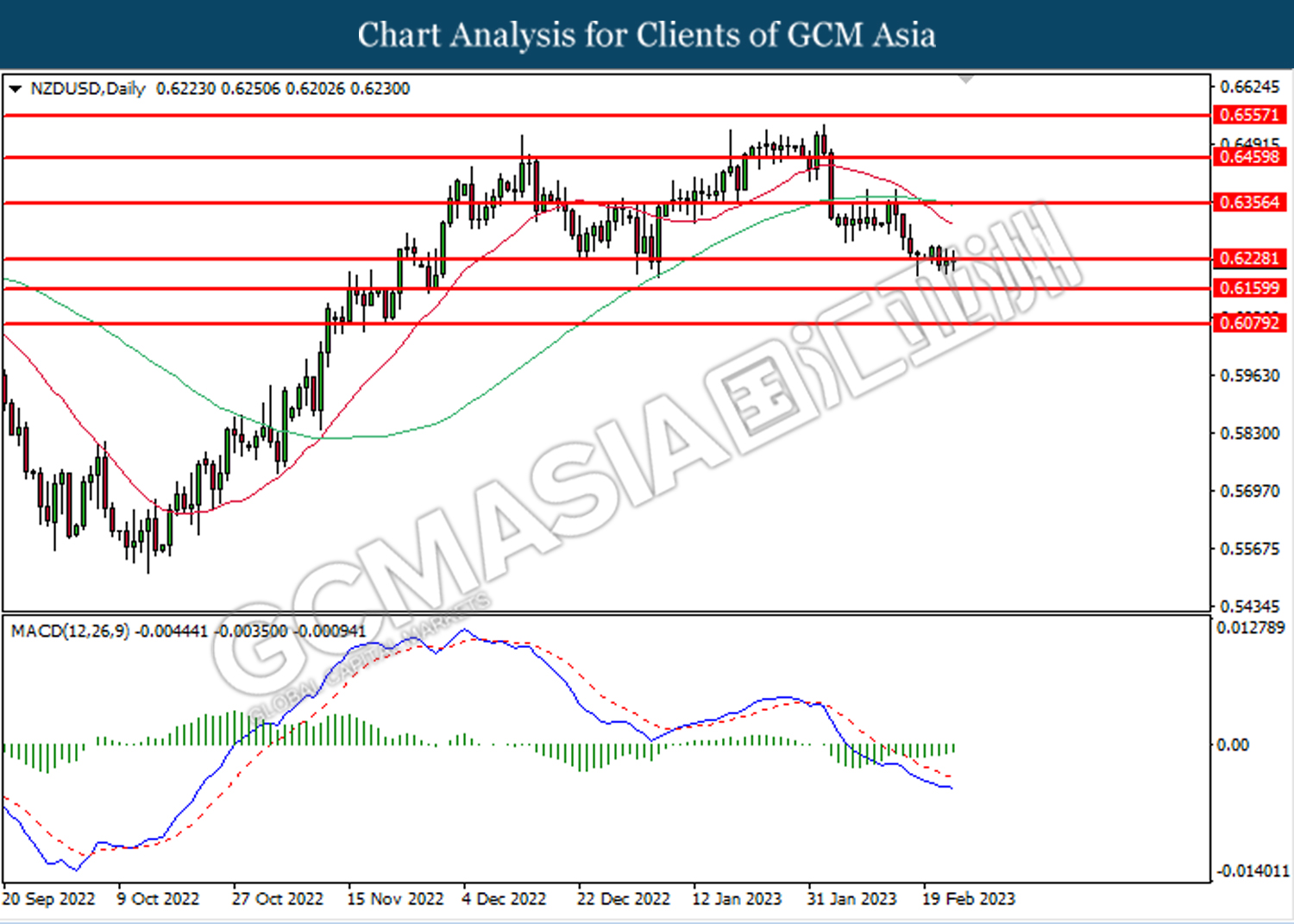

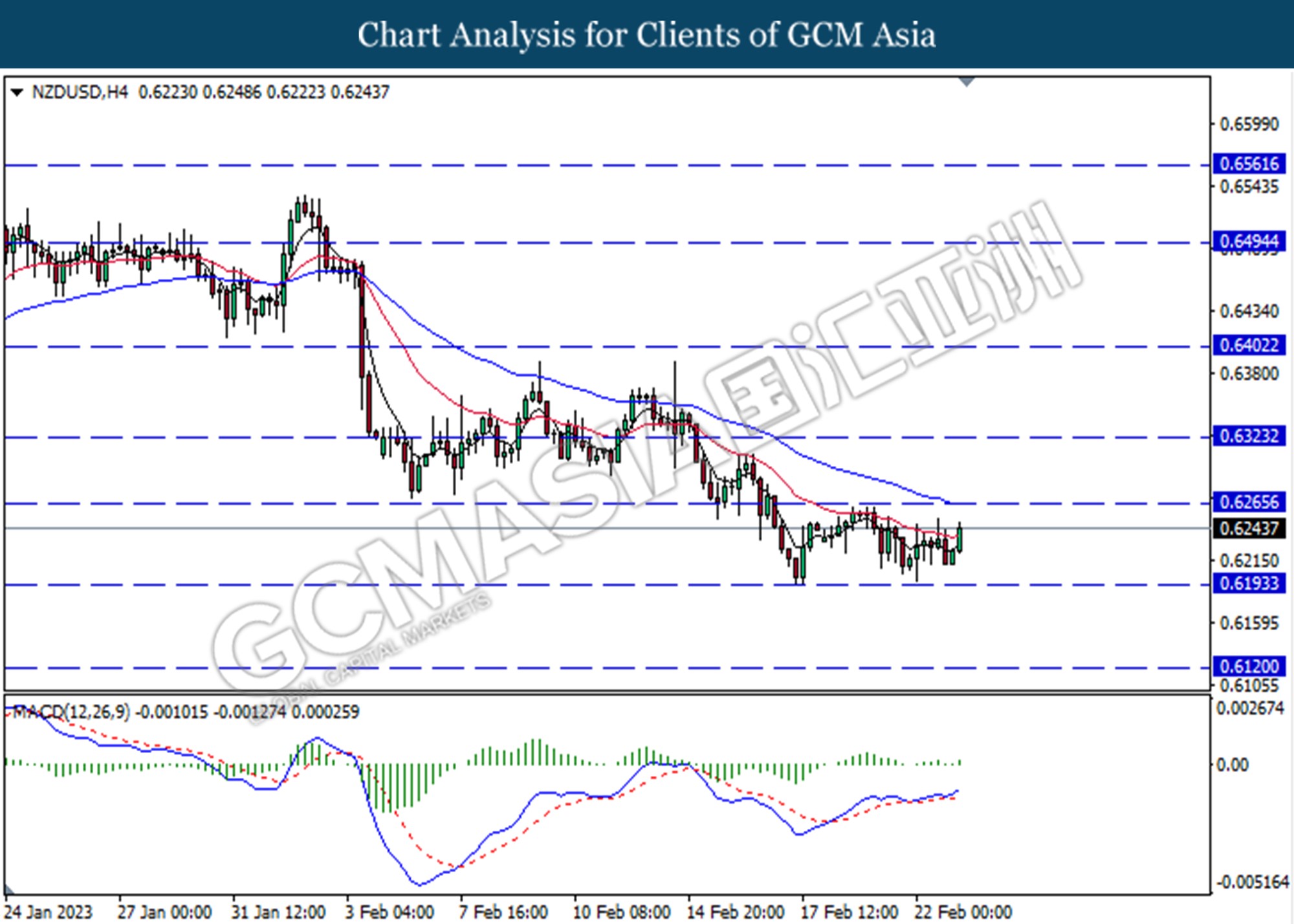

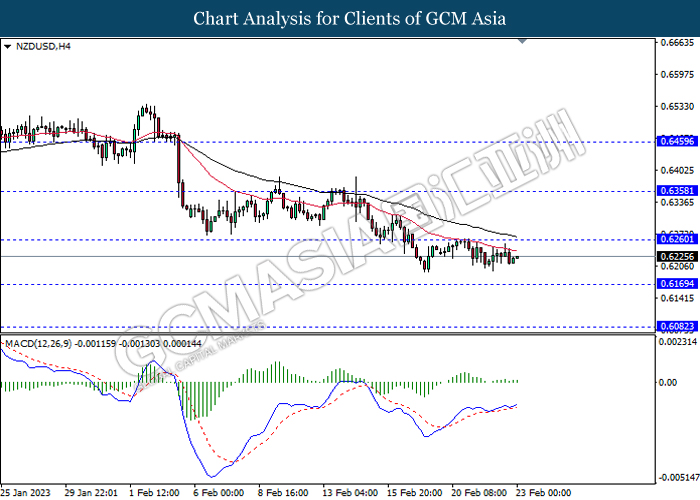

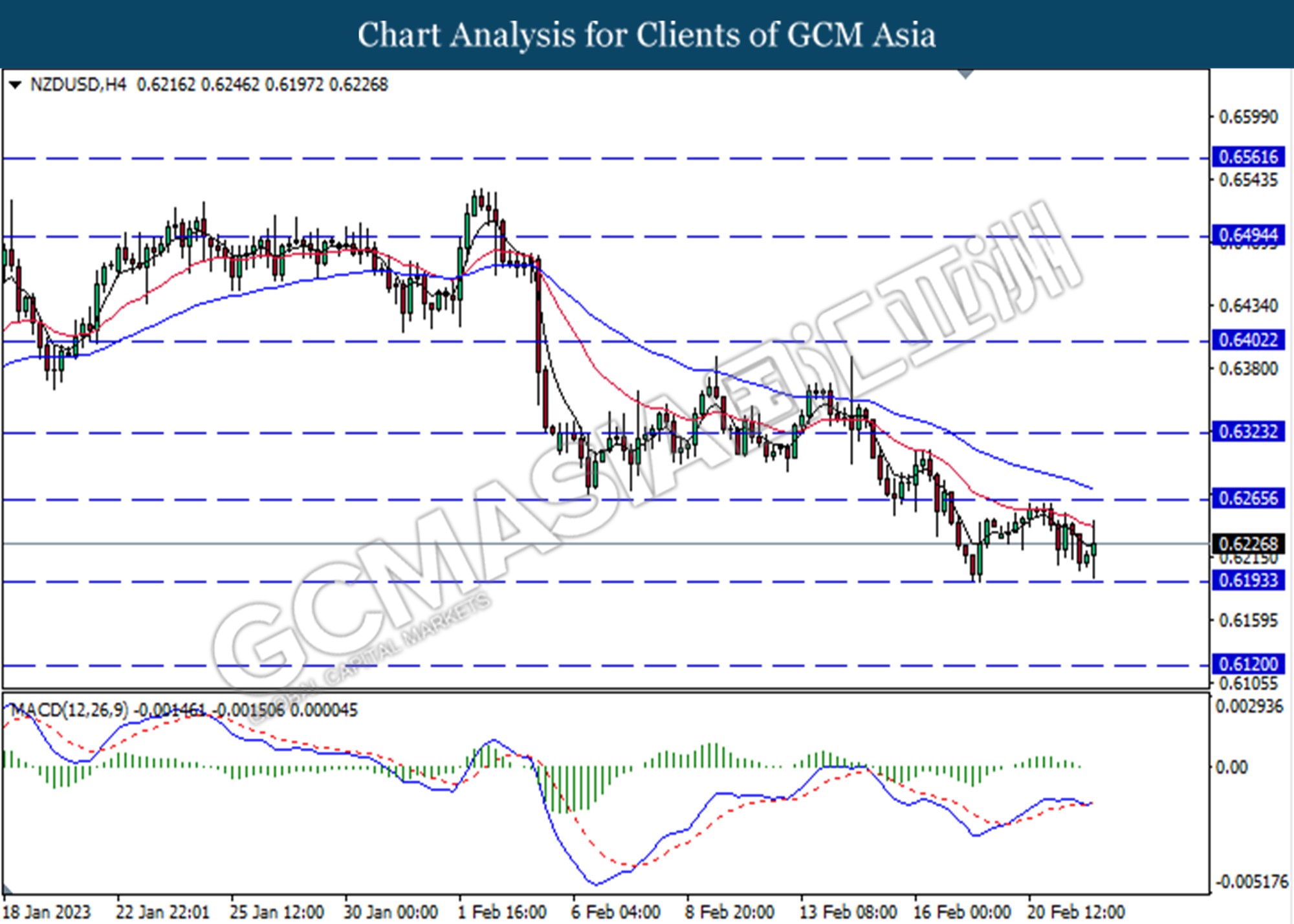

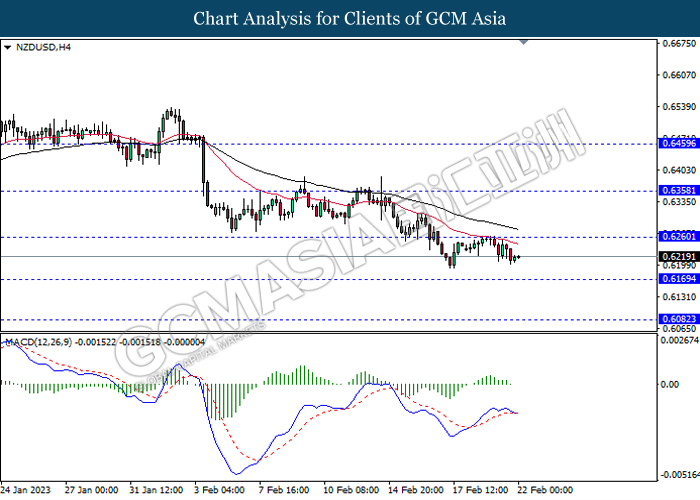

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6230. However, MACD which illustrated increasing bullish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6230, 0.6160

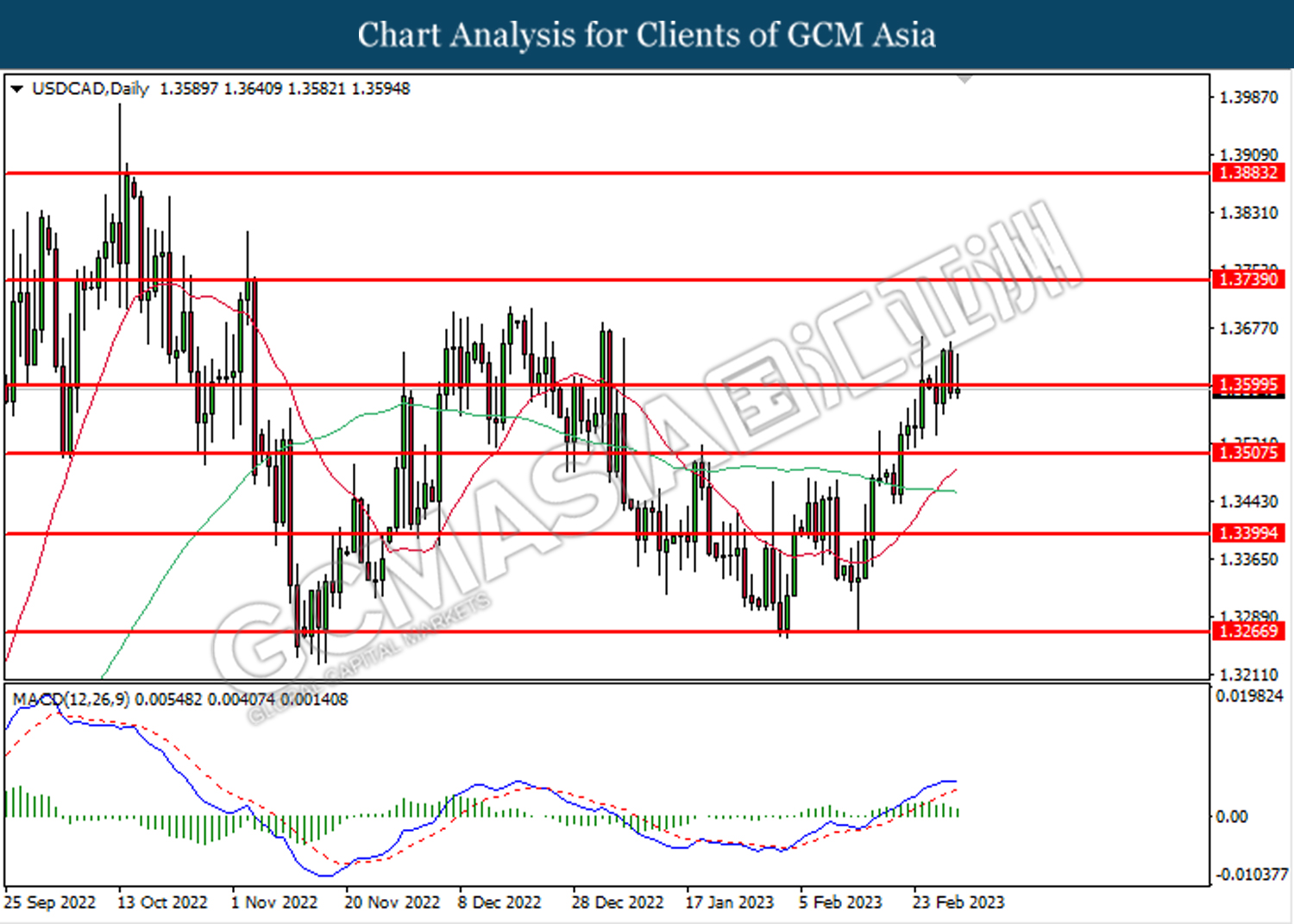

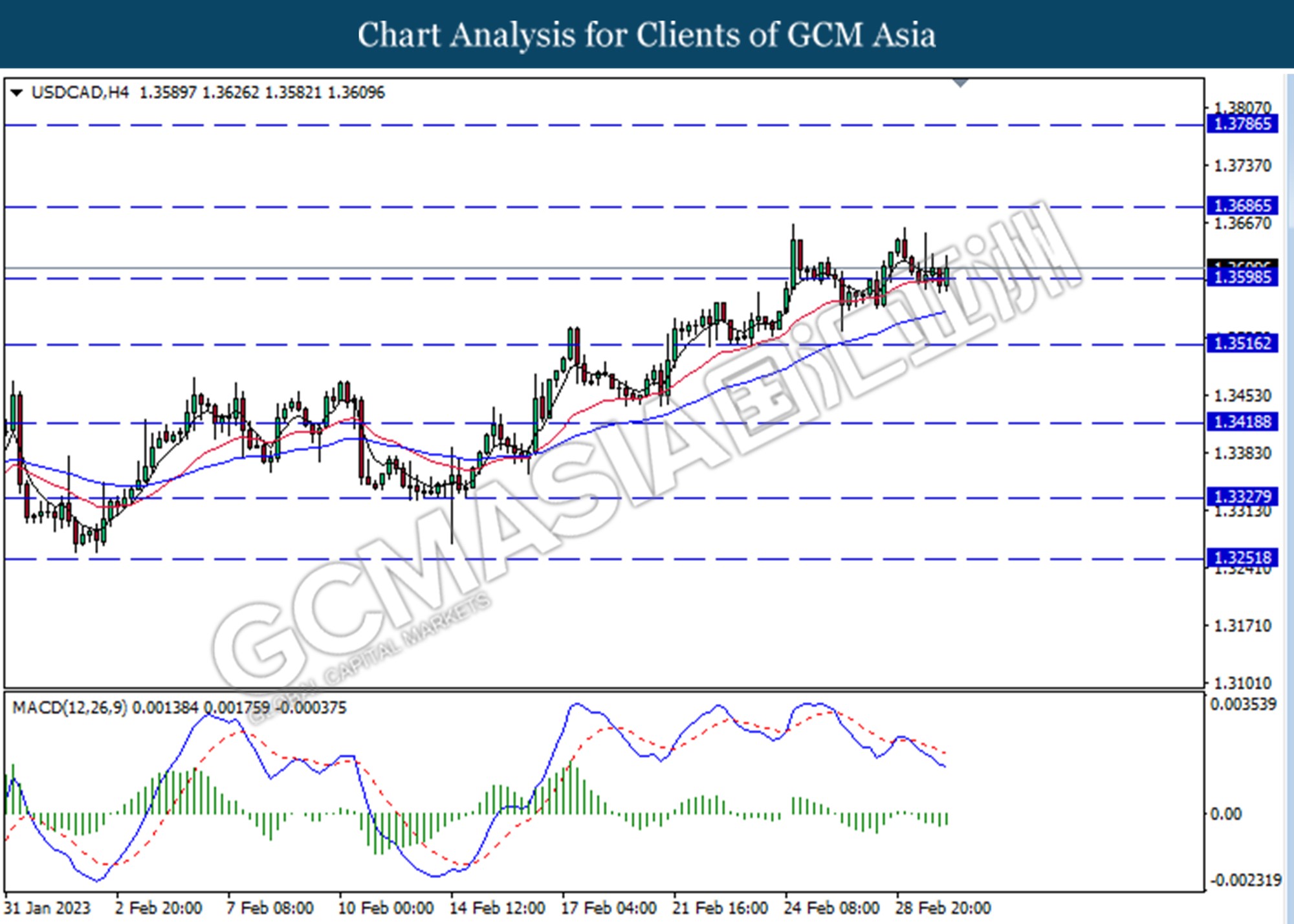

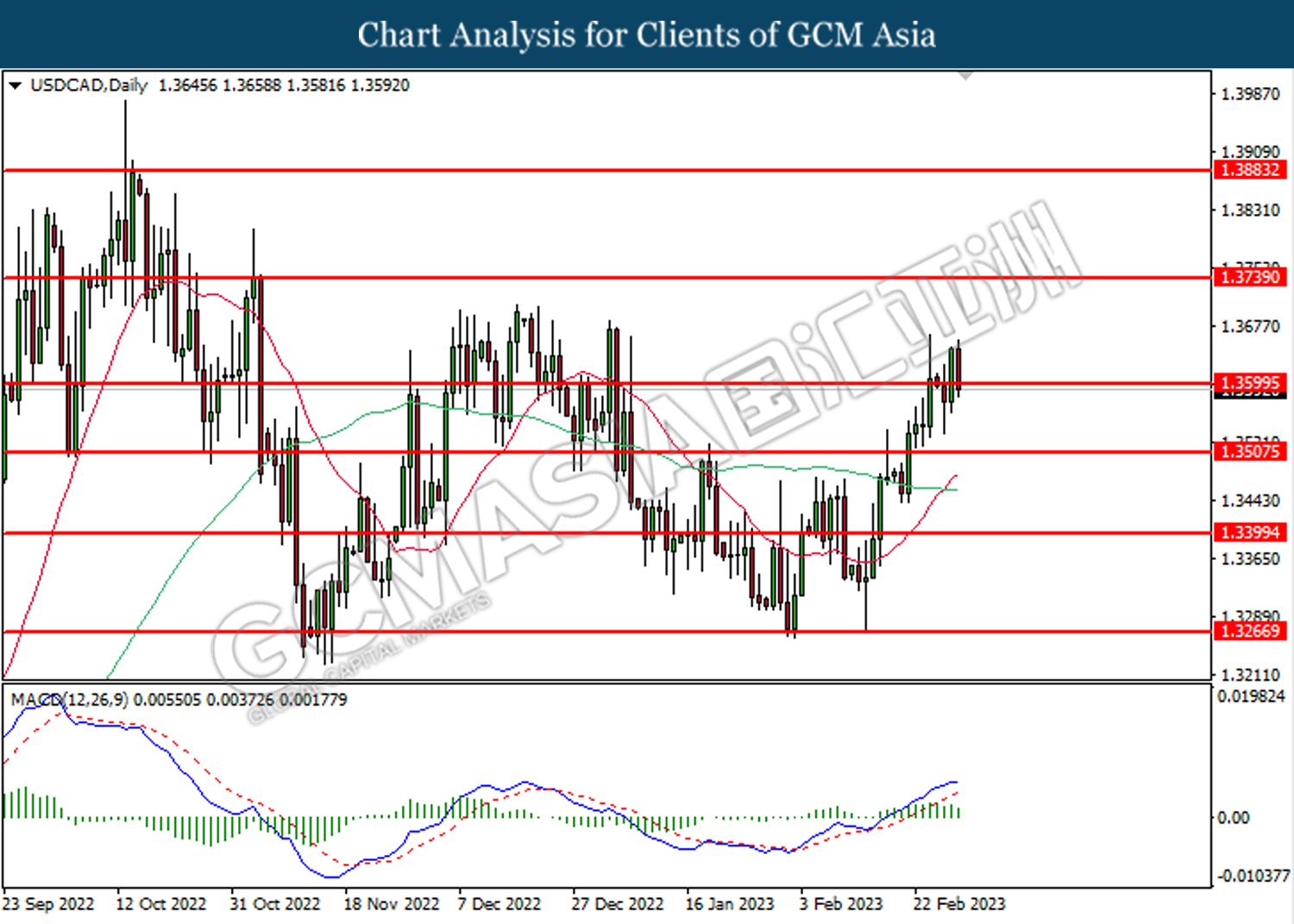

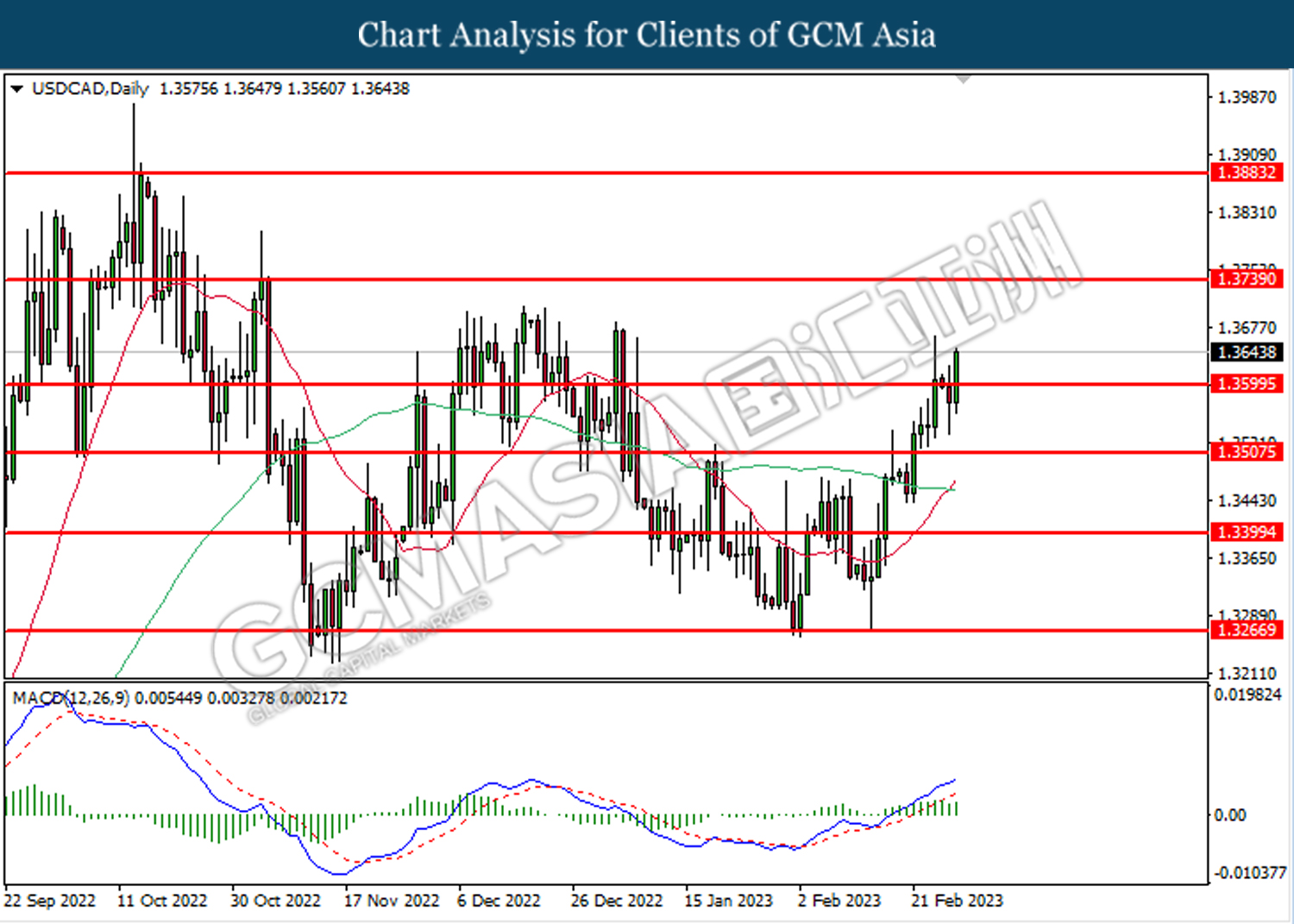

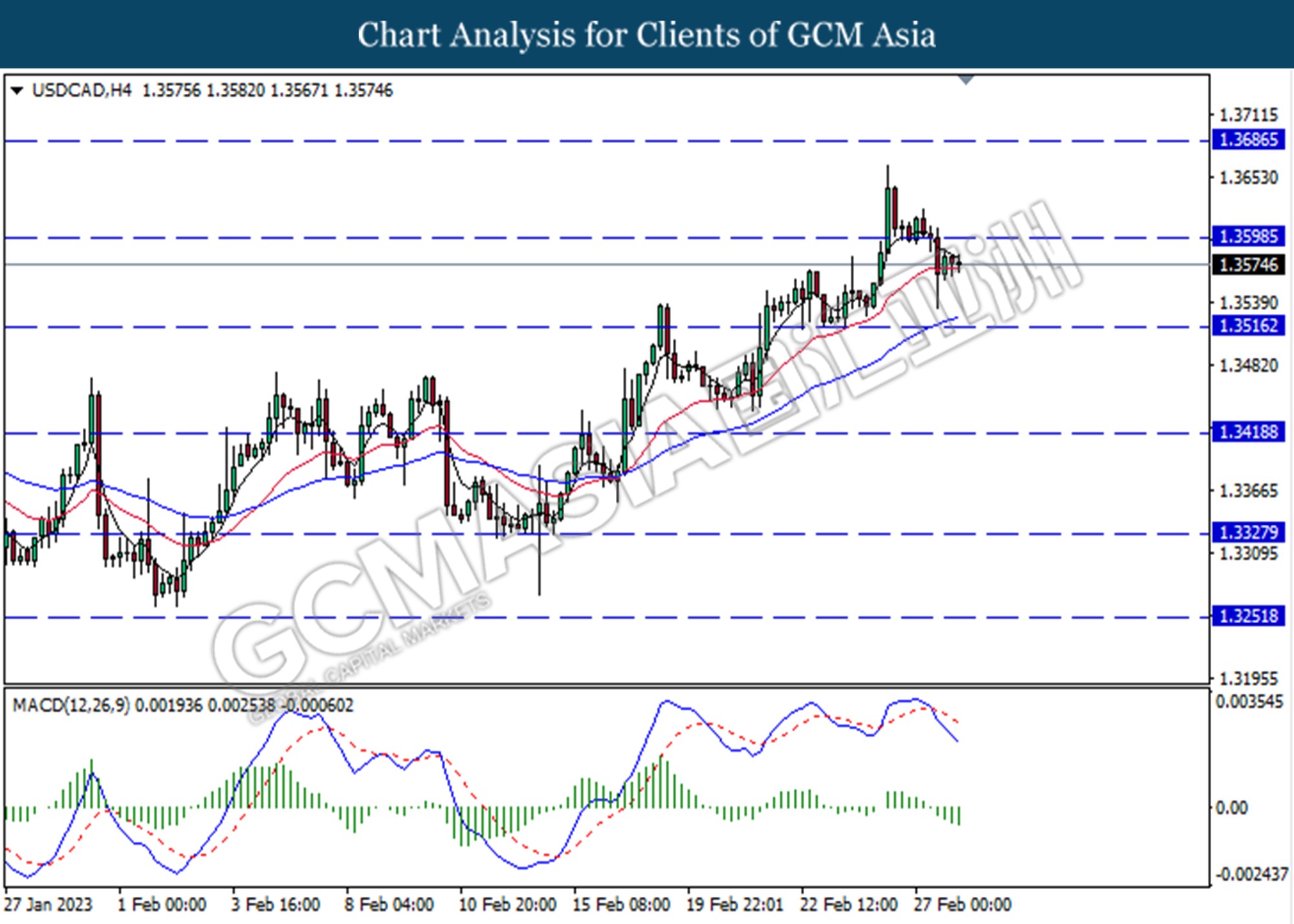

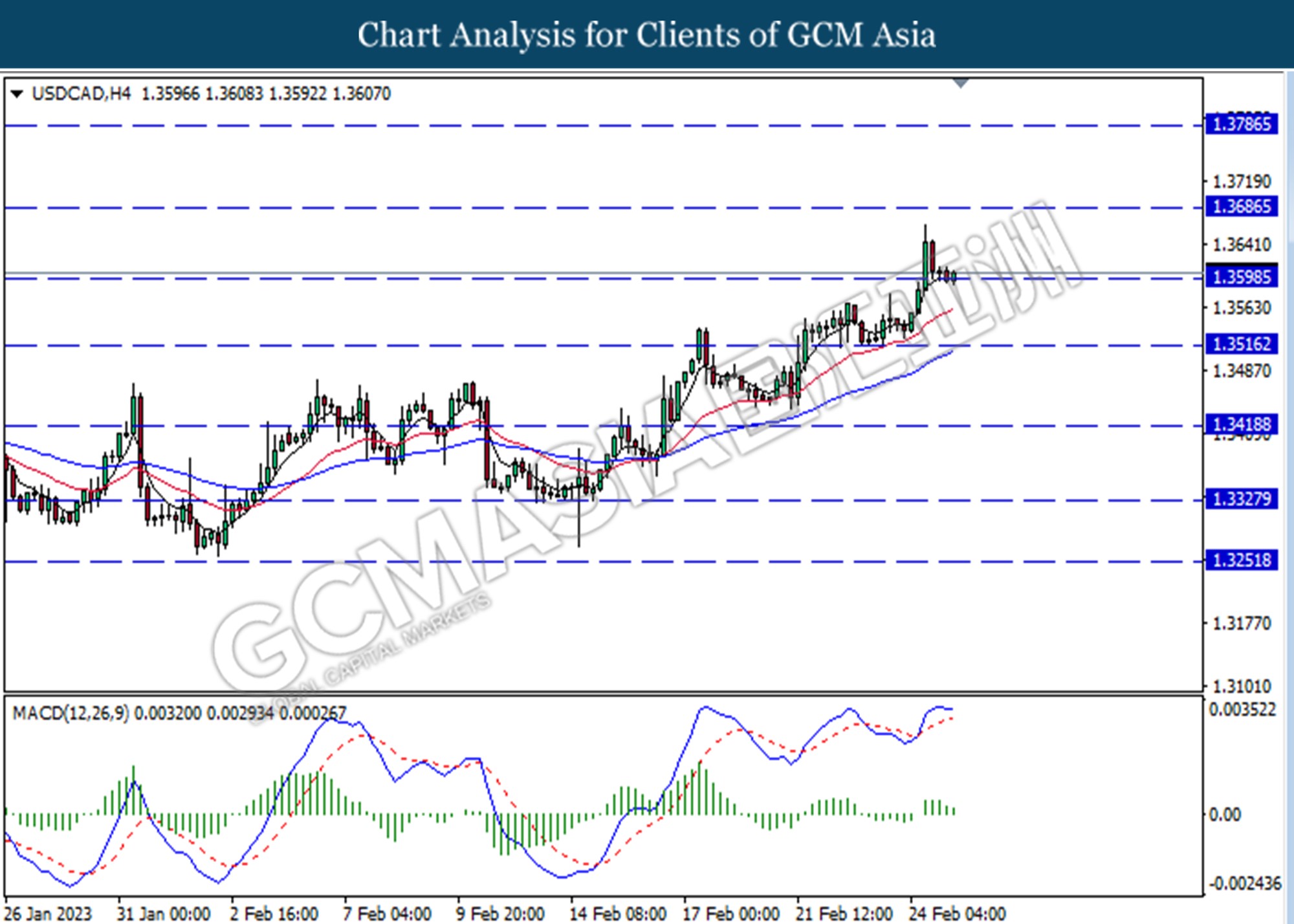

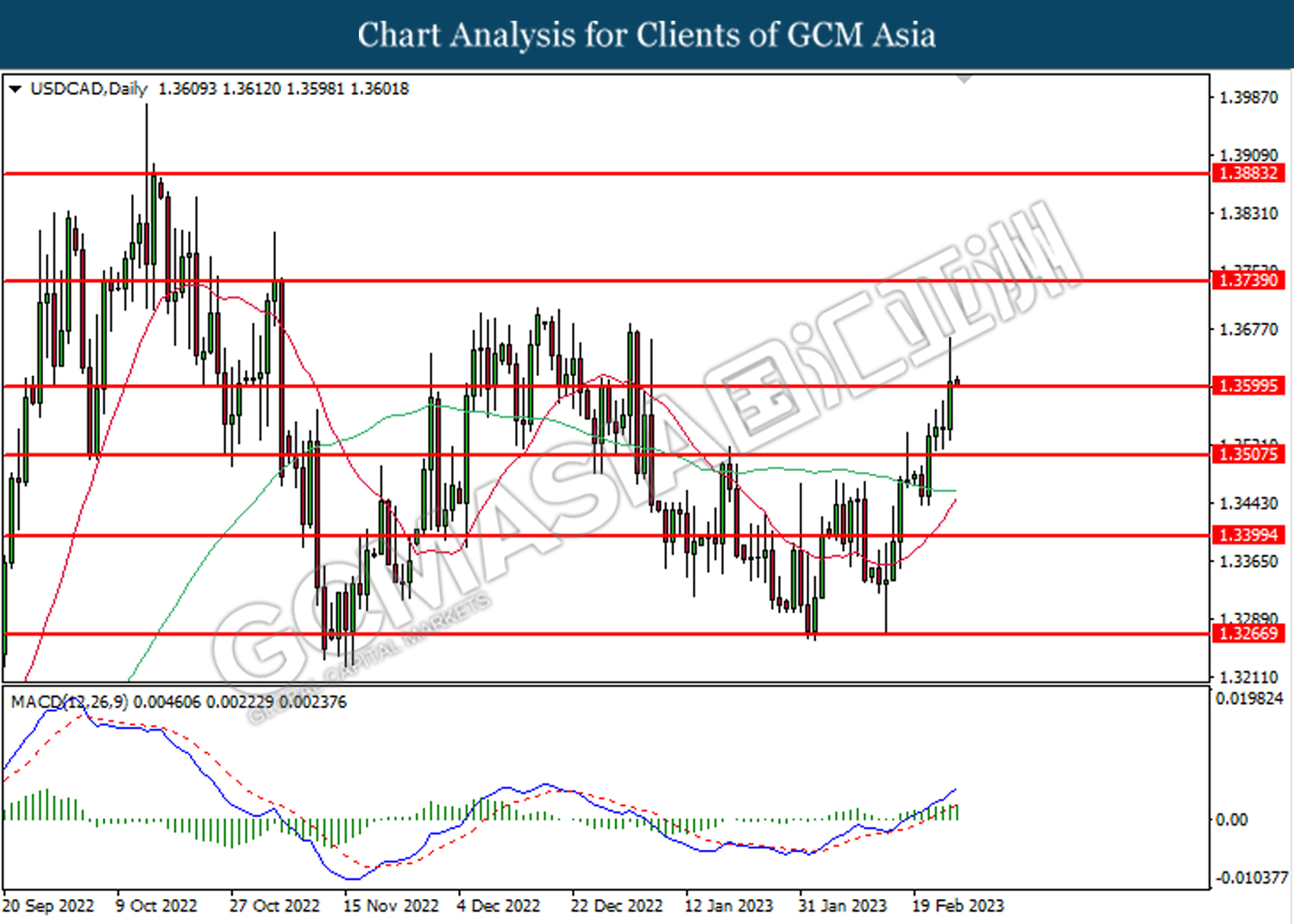

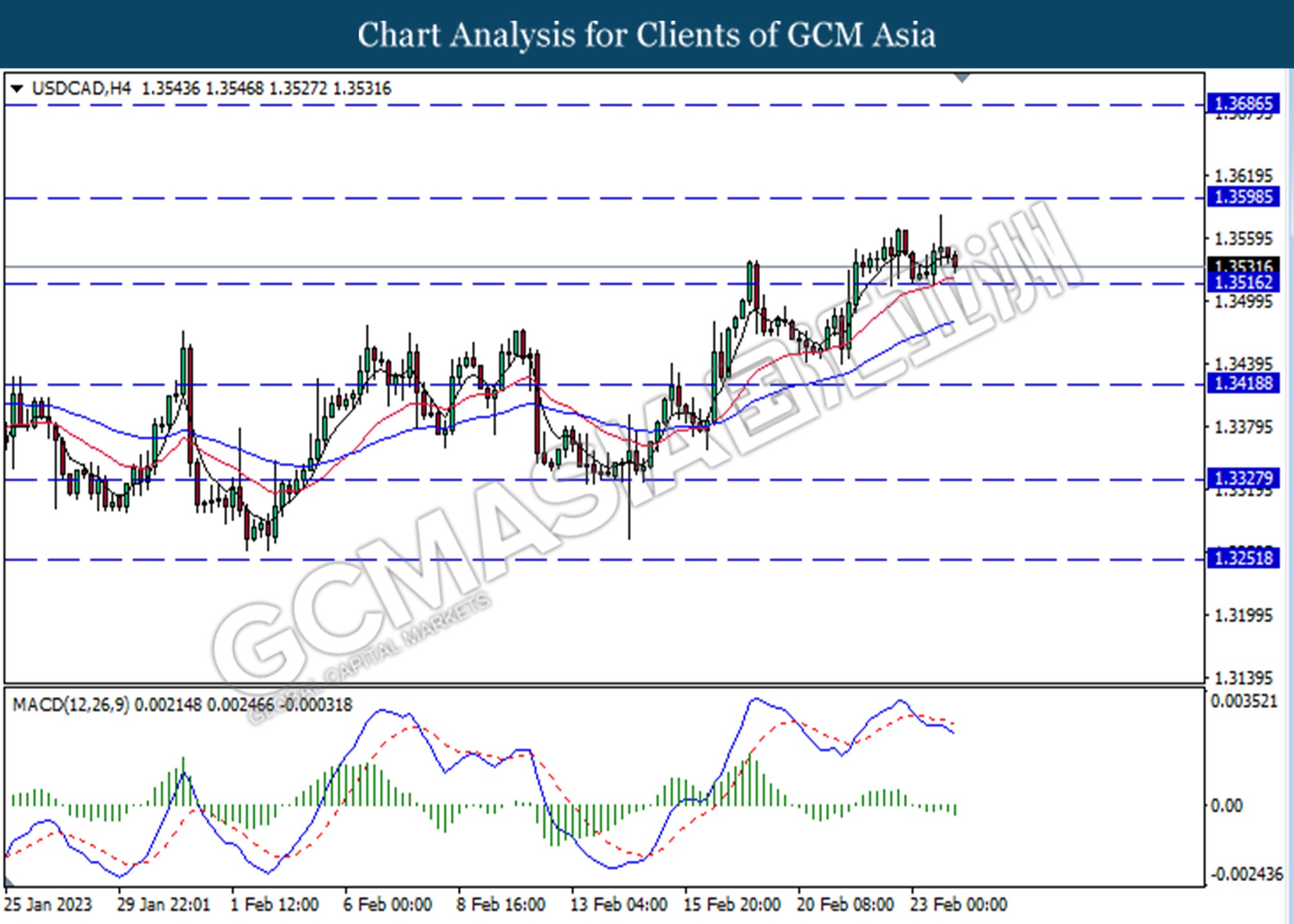

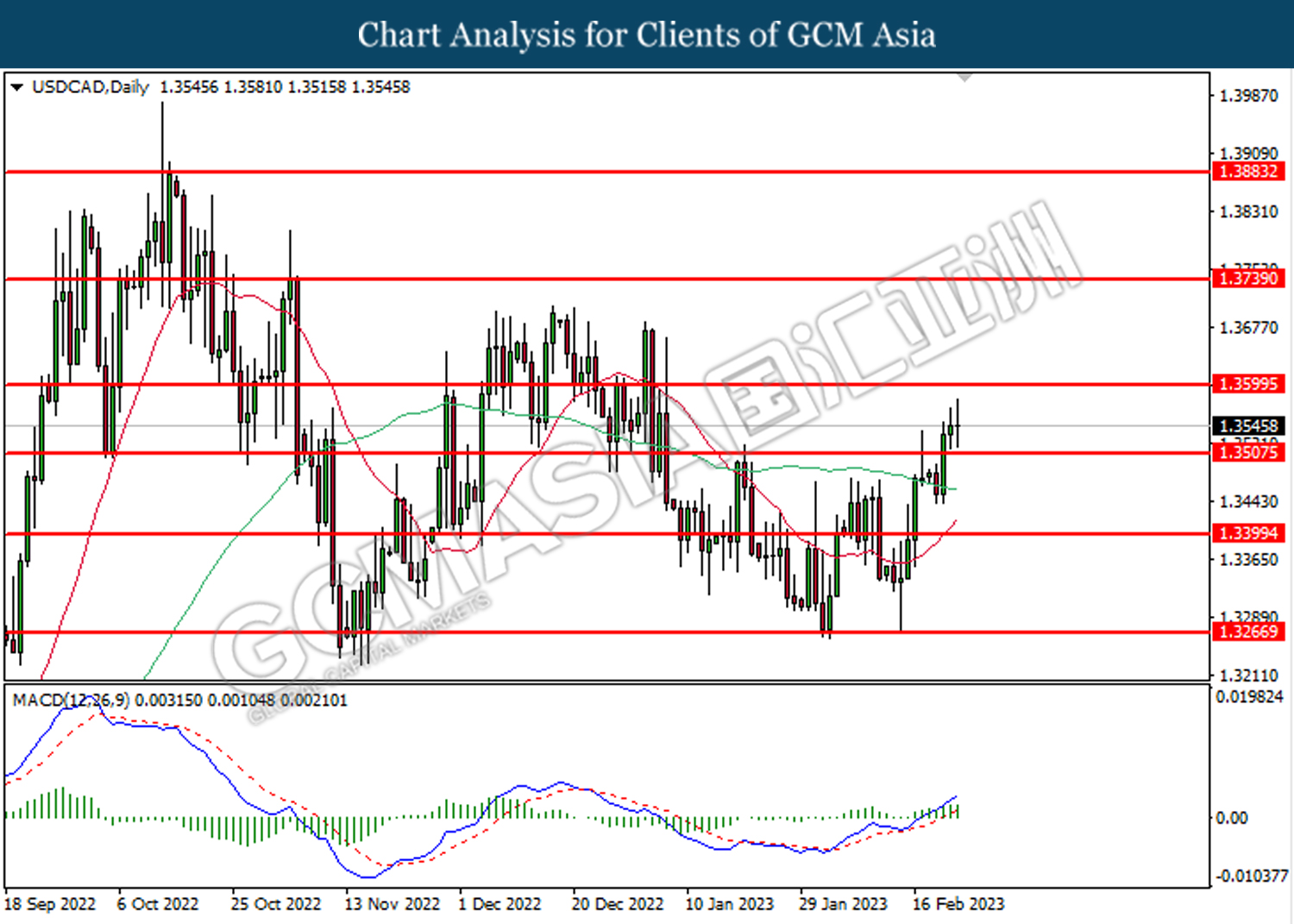

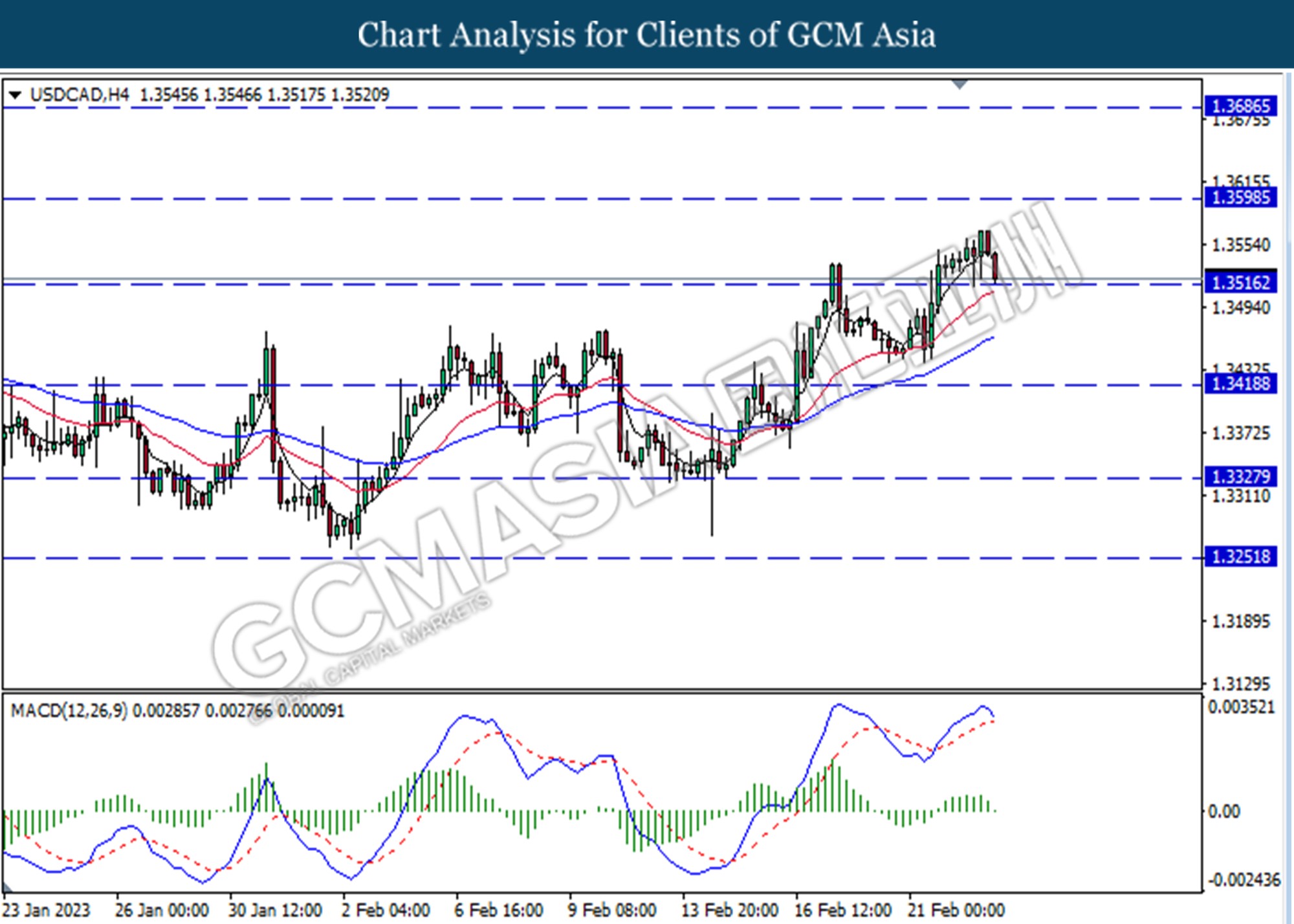

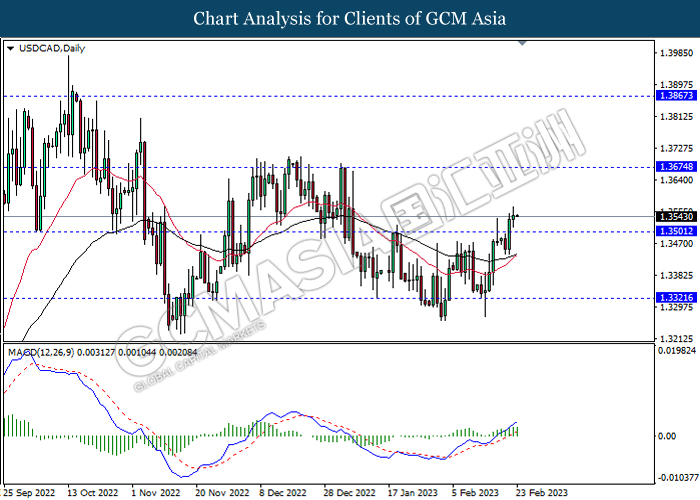

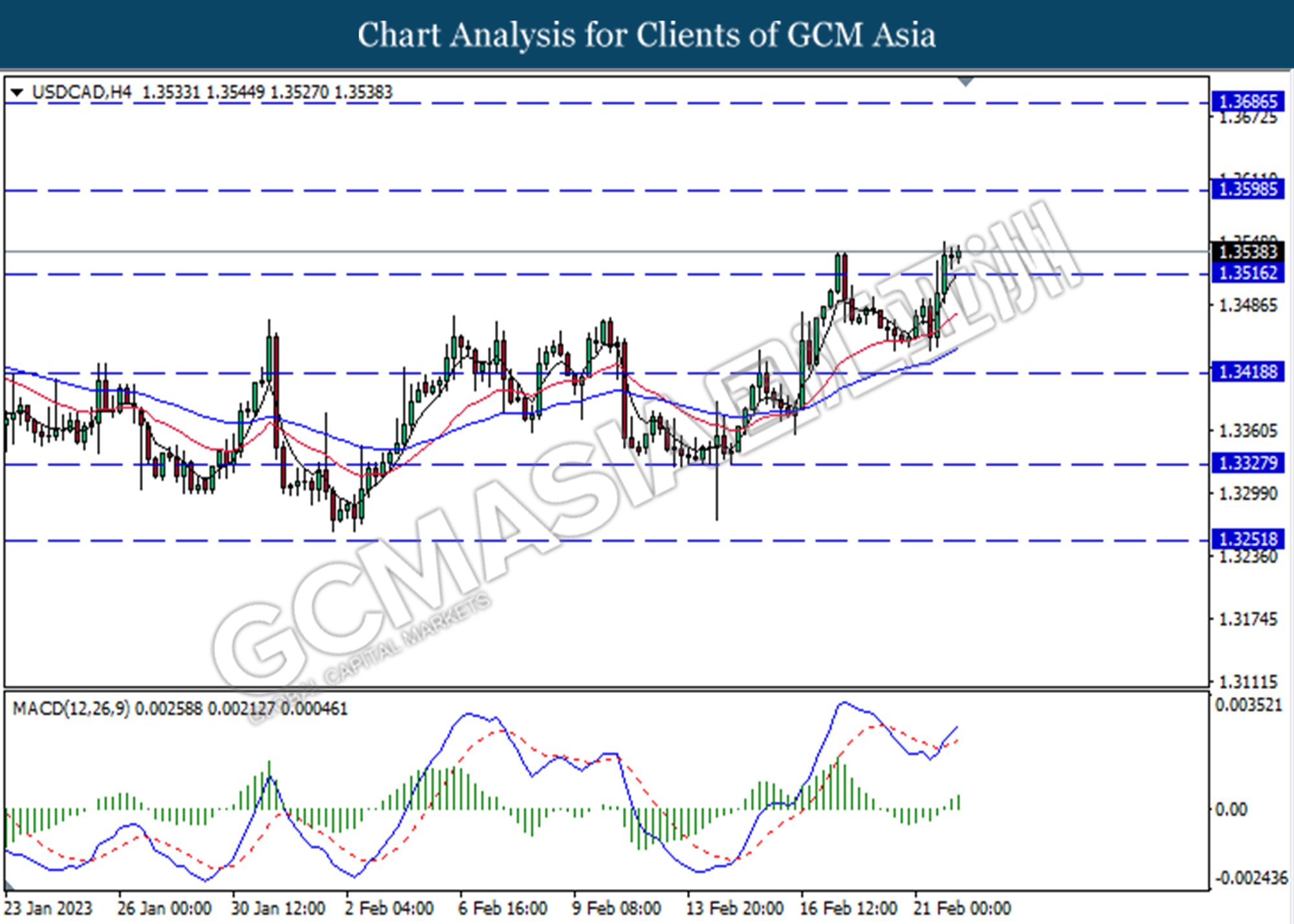

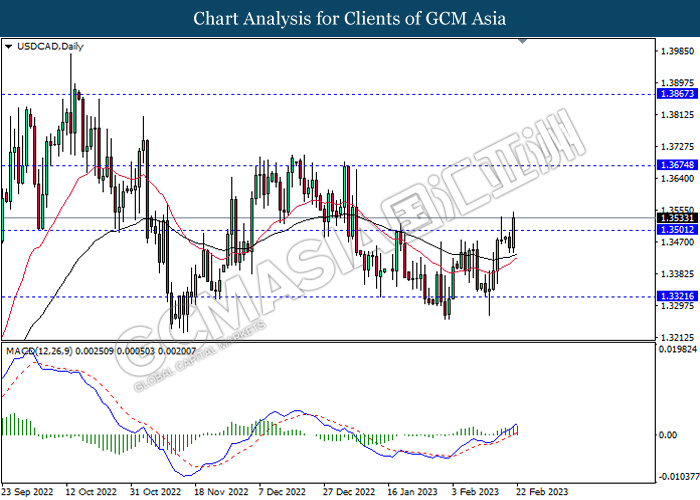

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

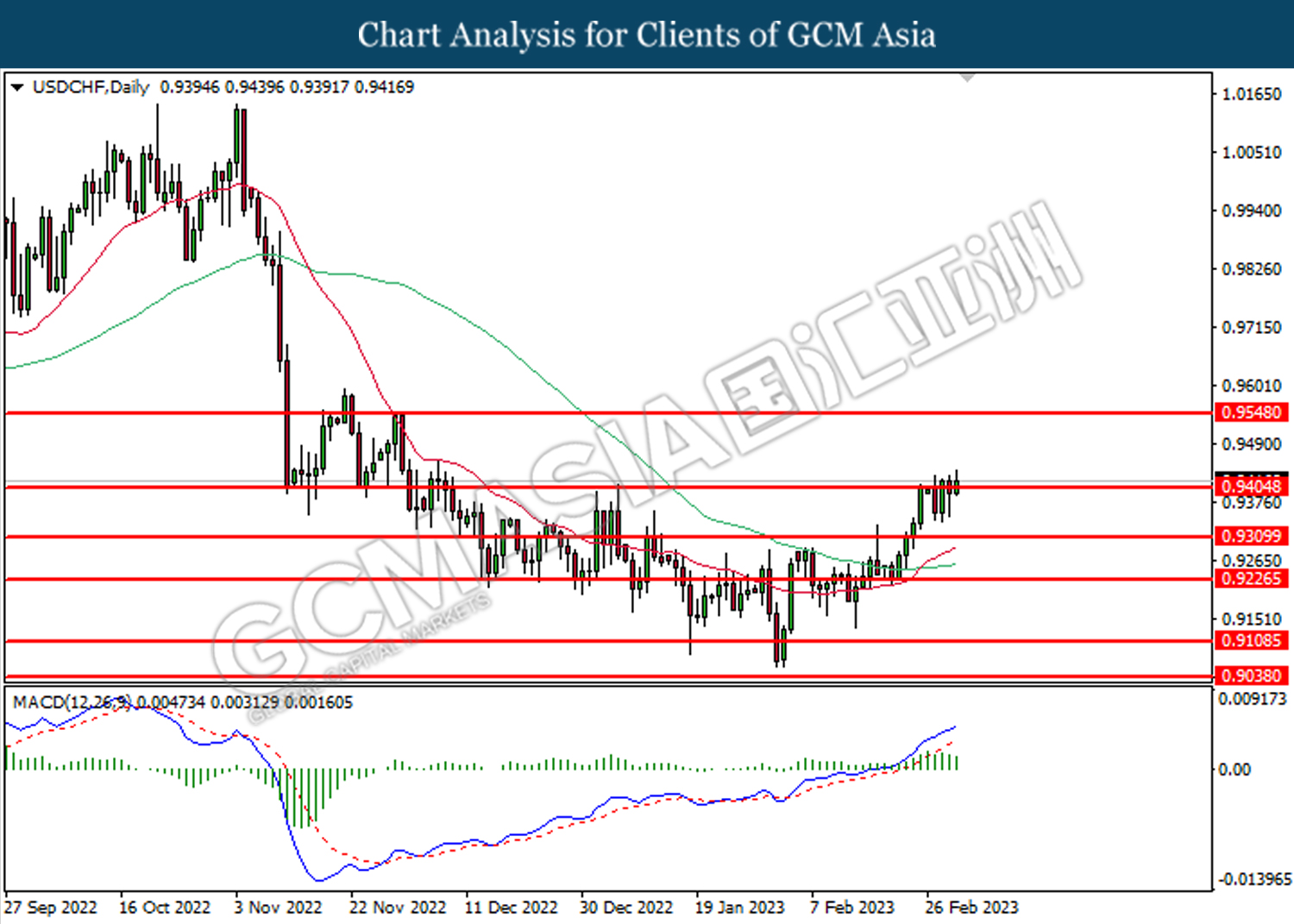

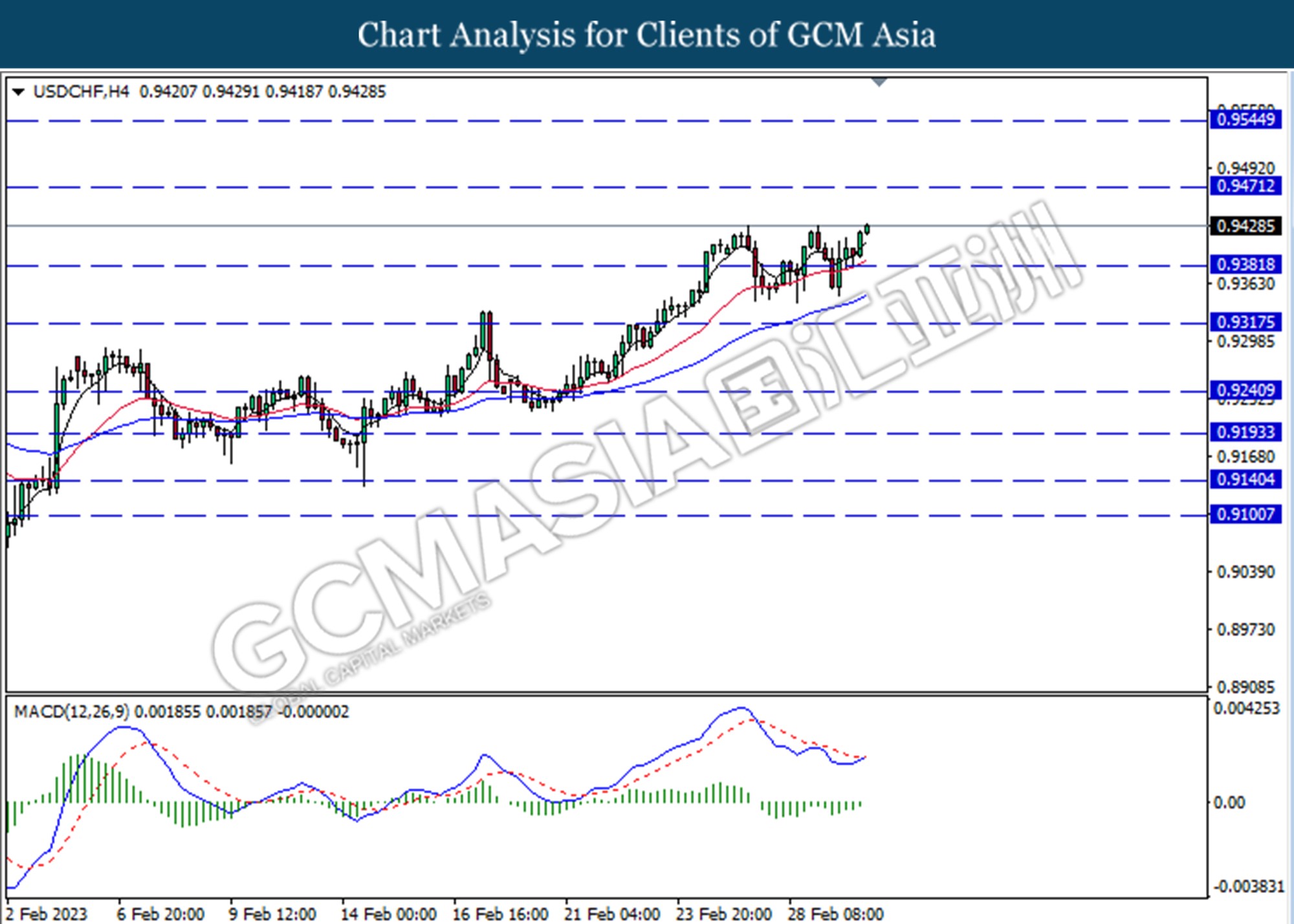

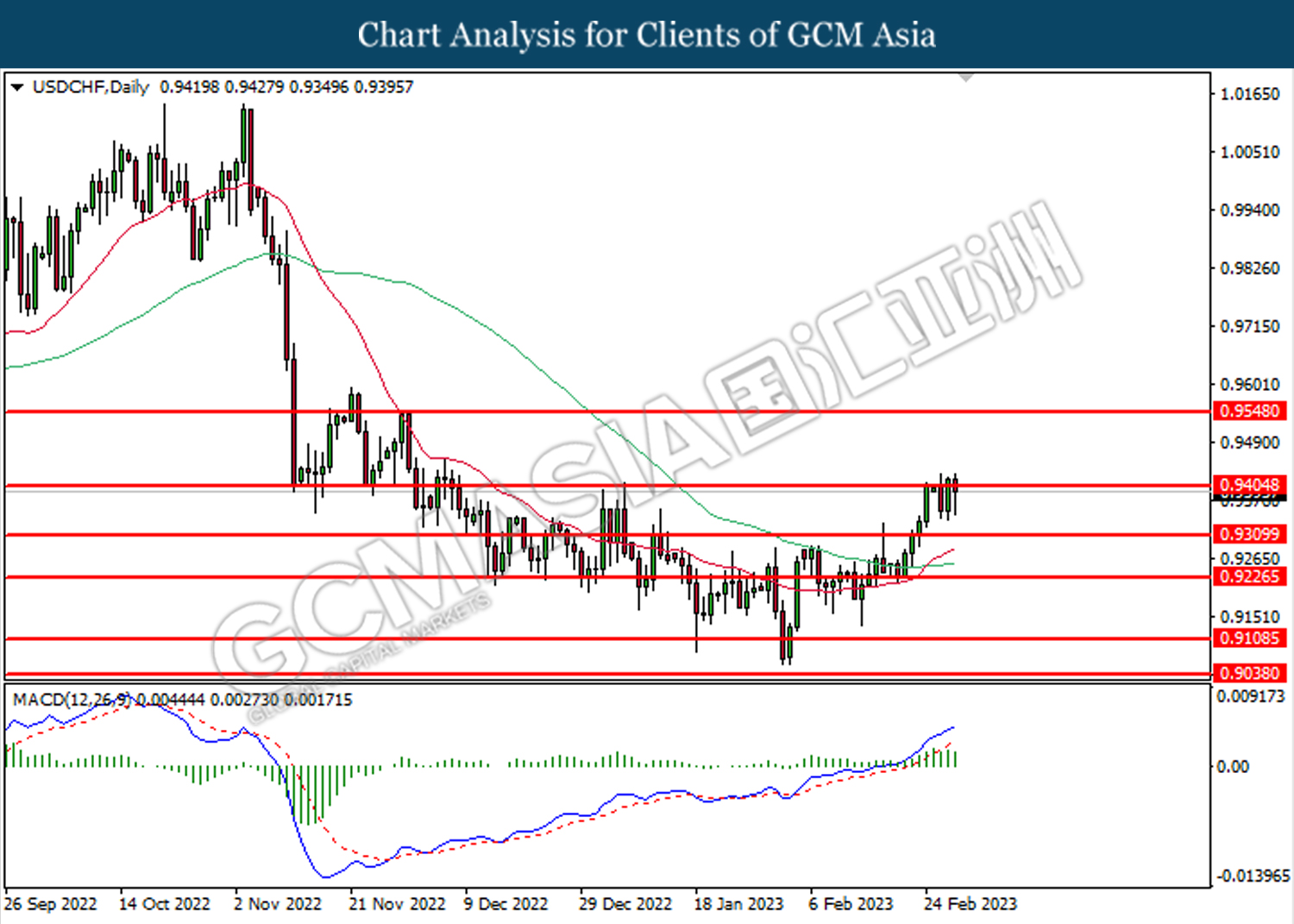

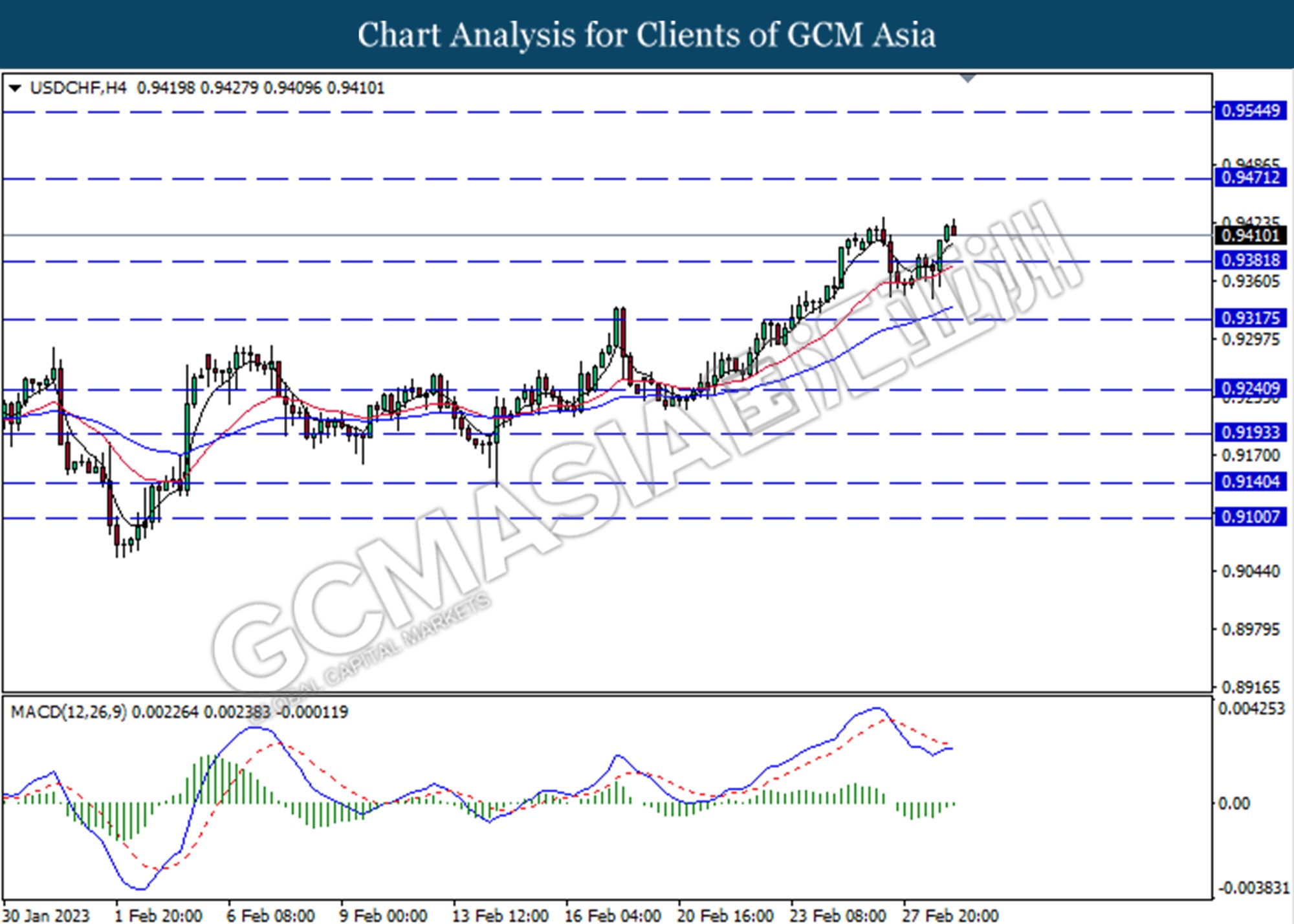

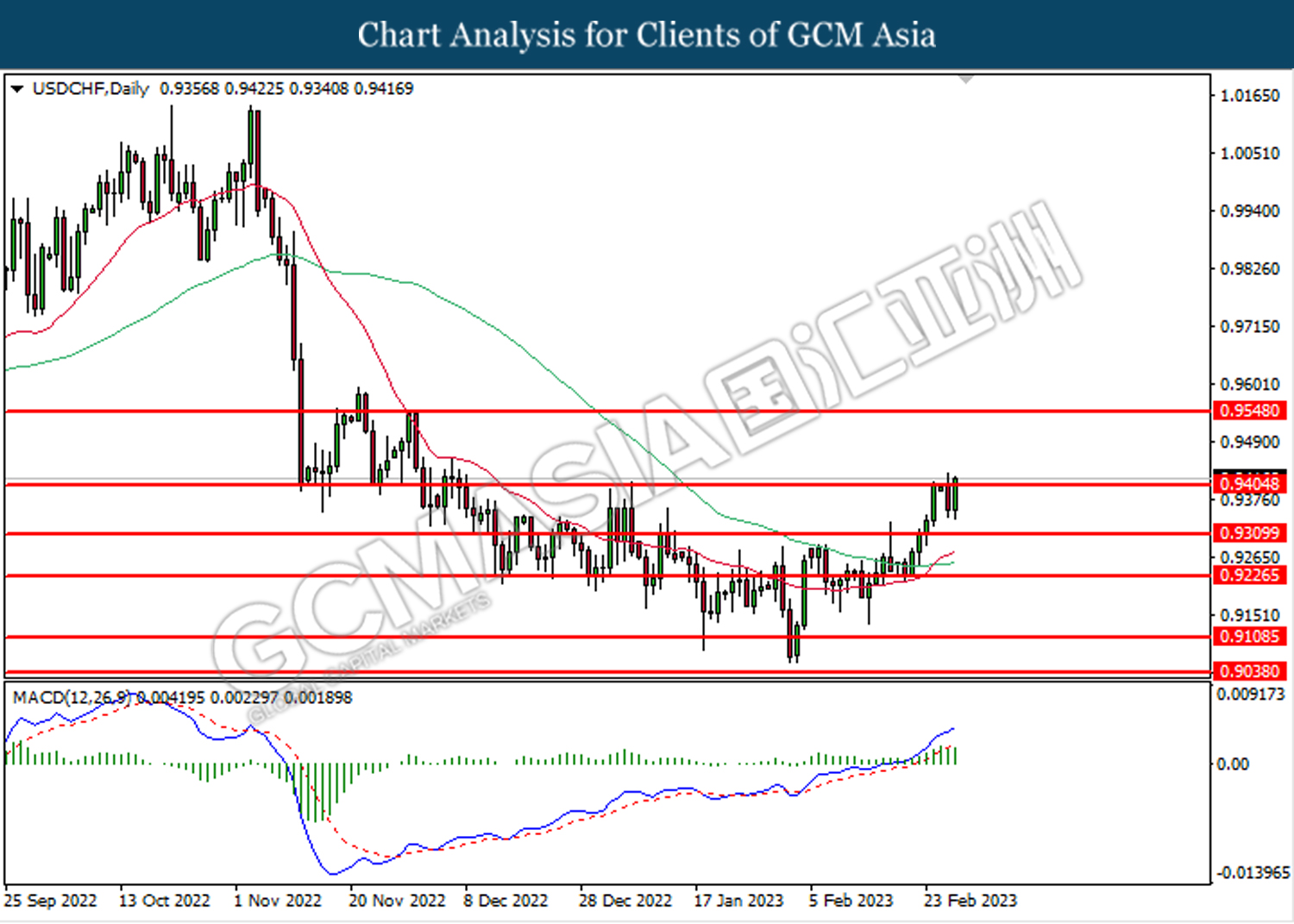

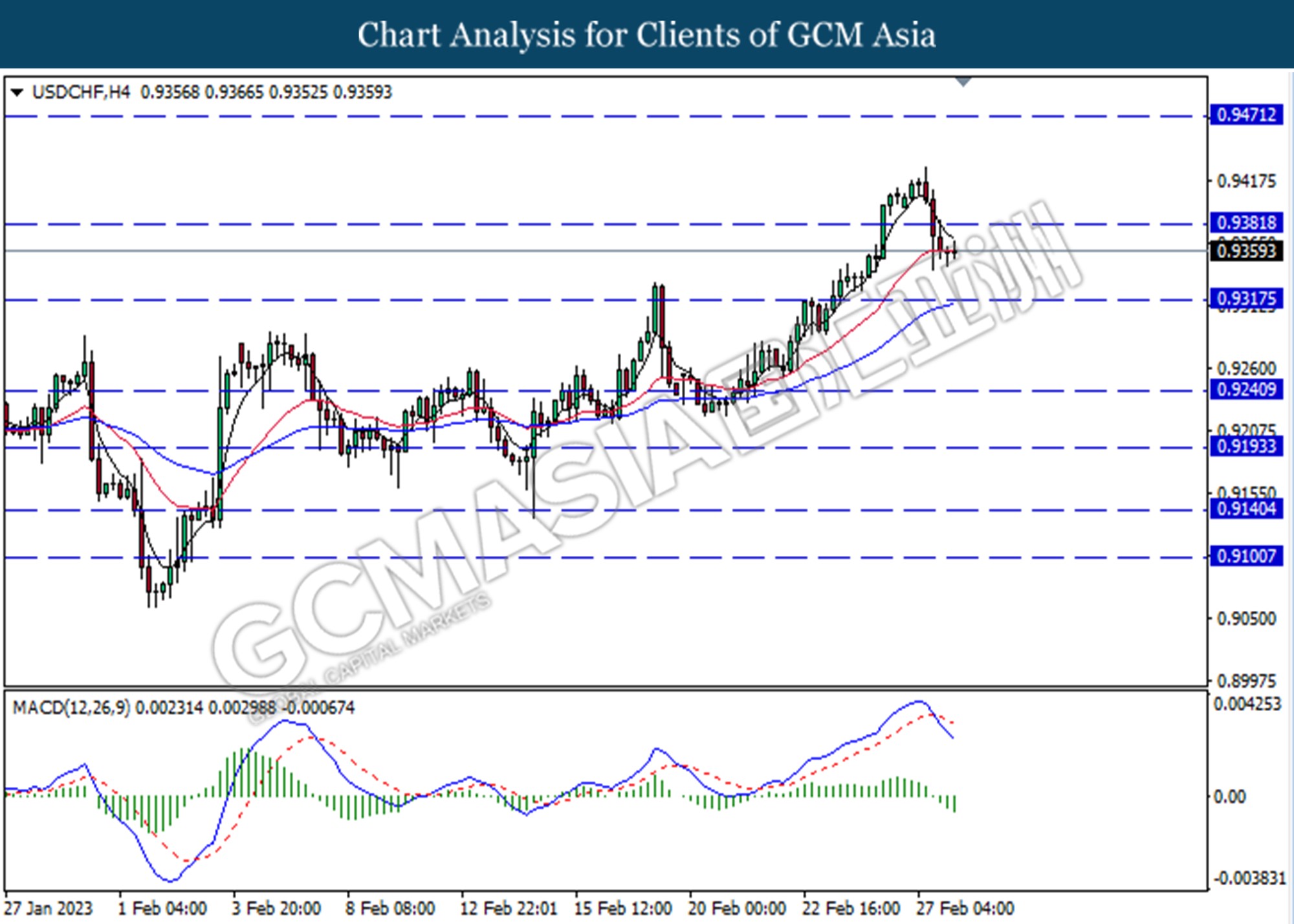

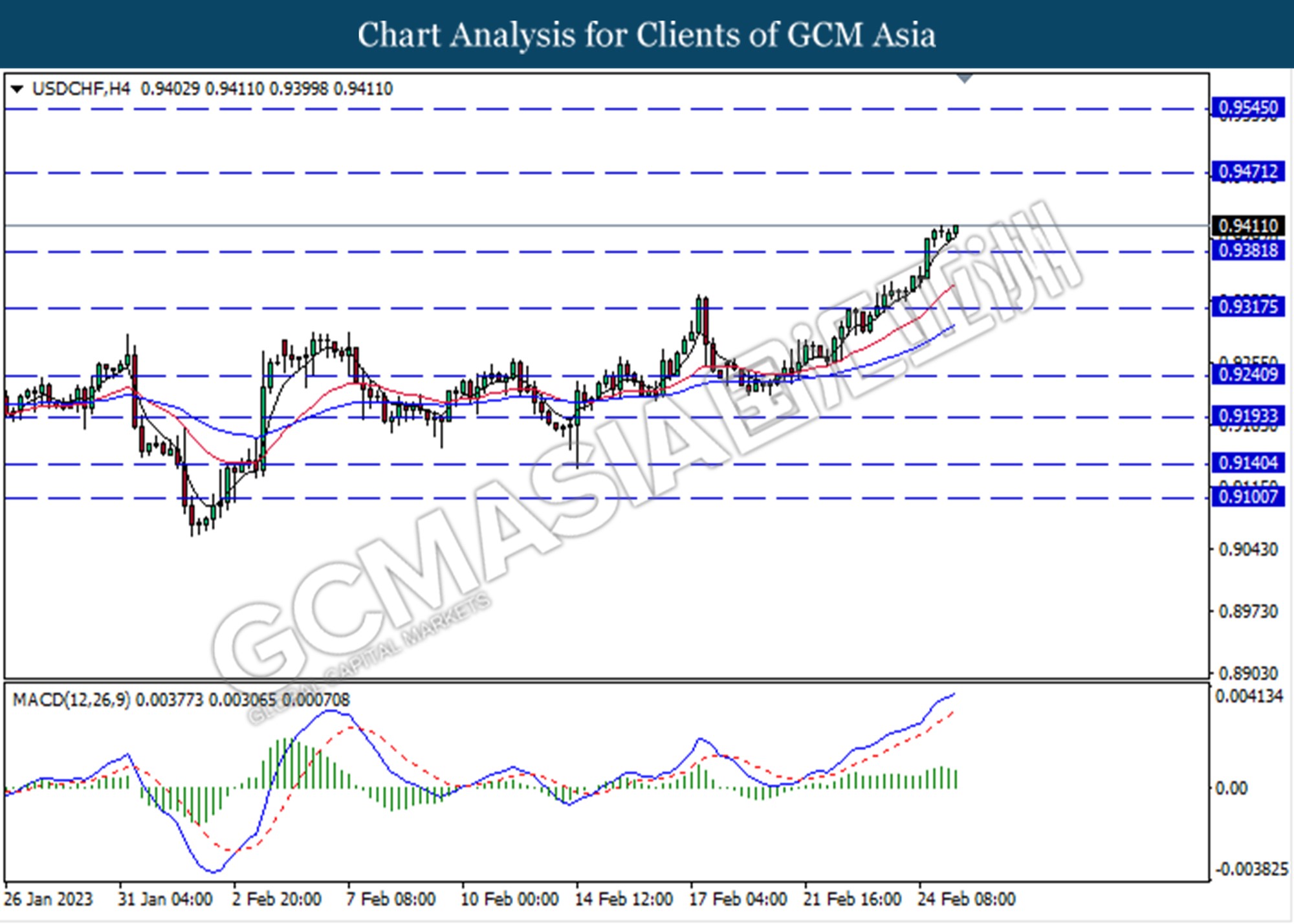

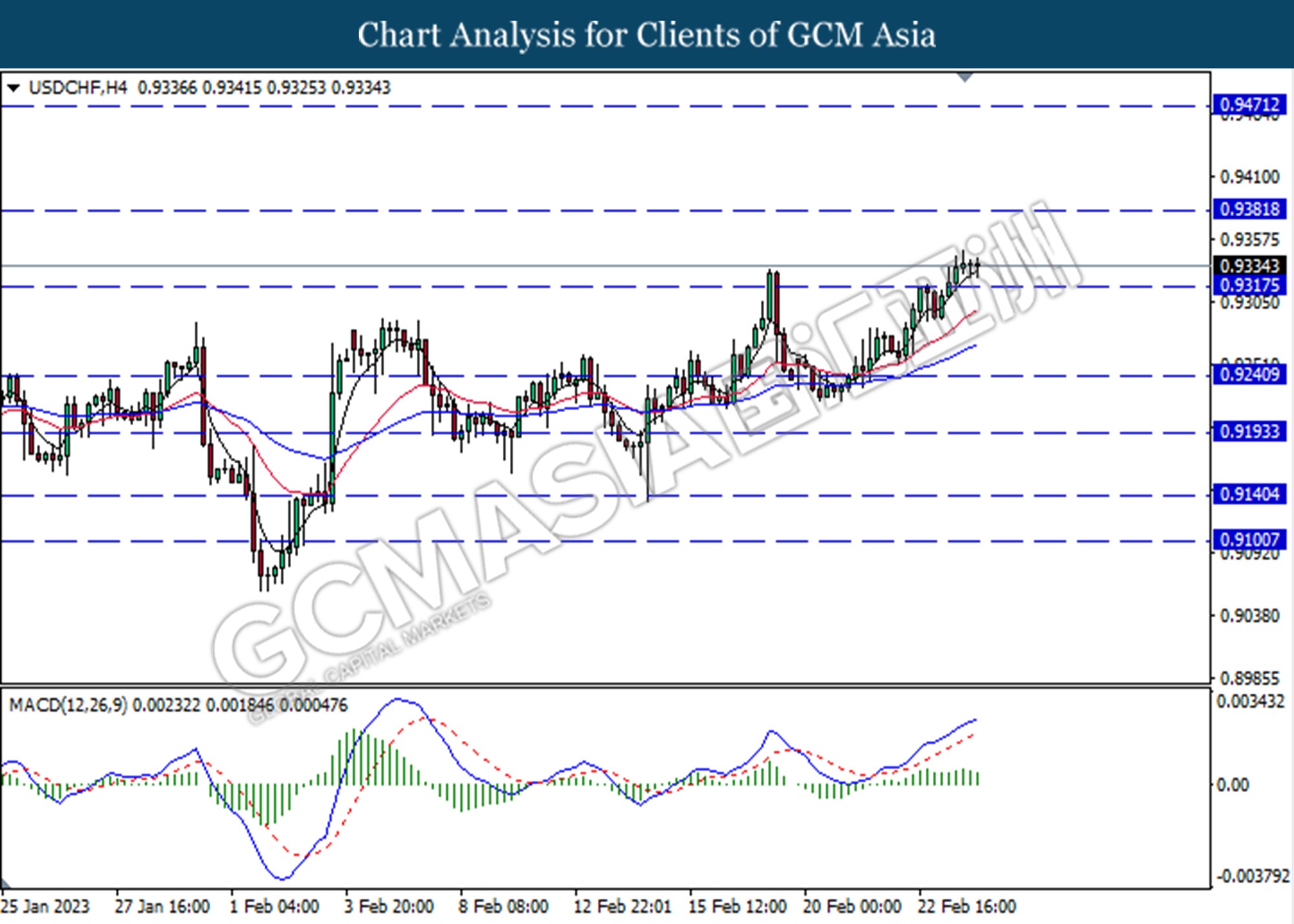

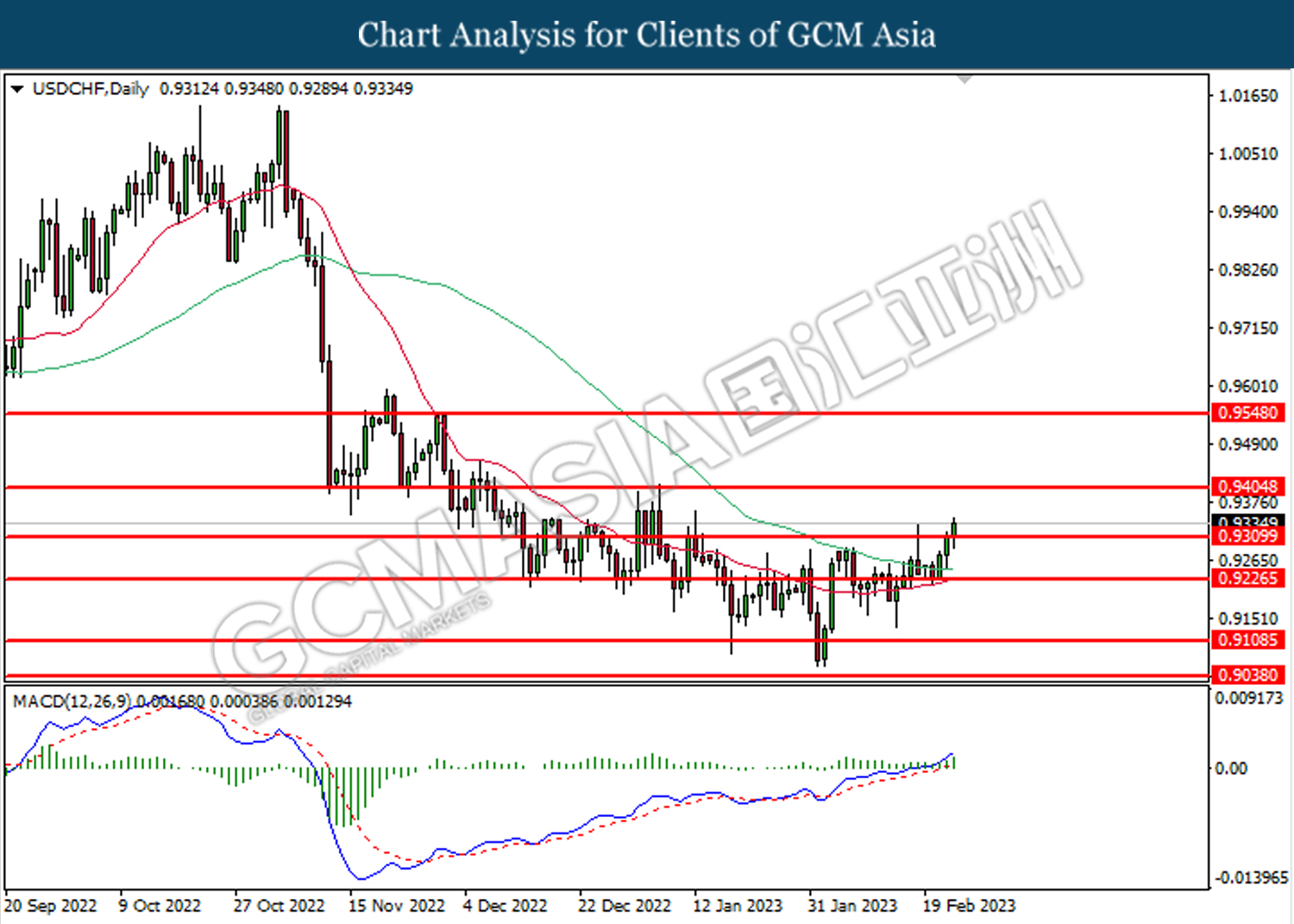

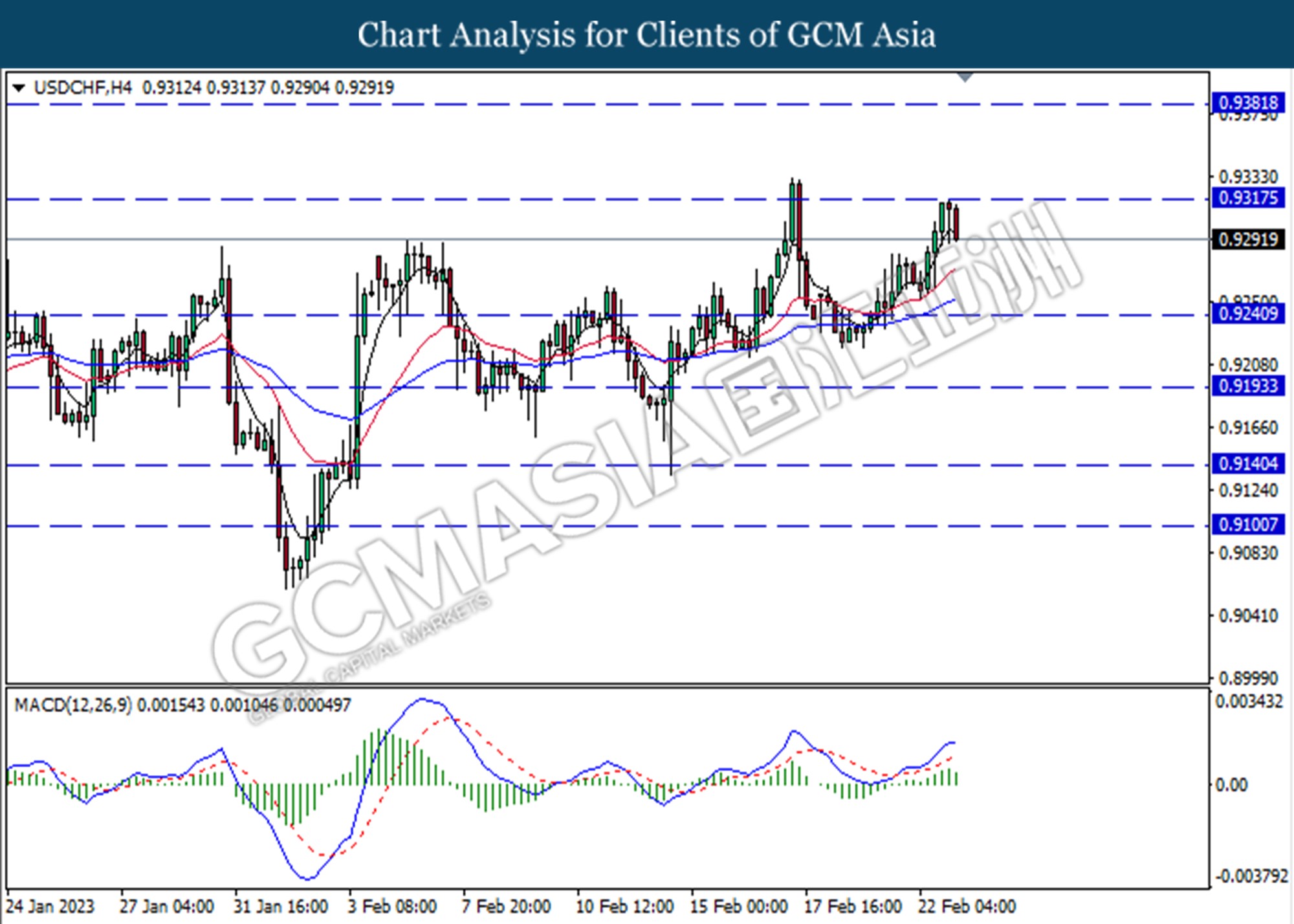

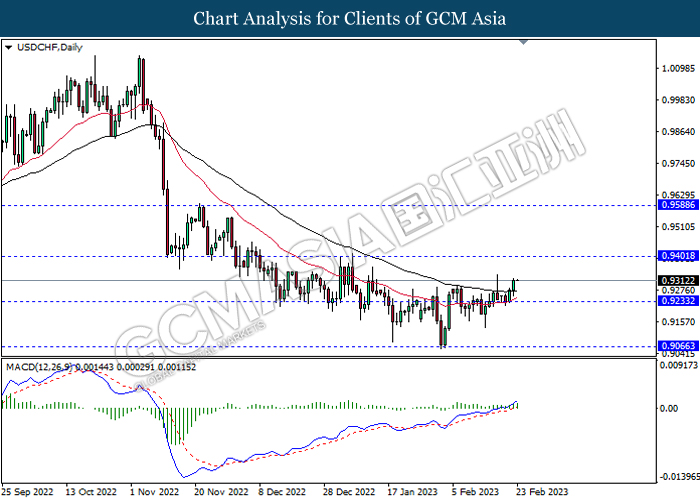

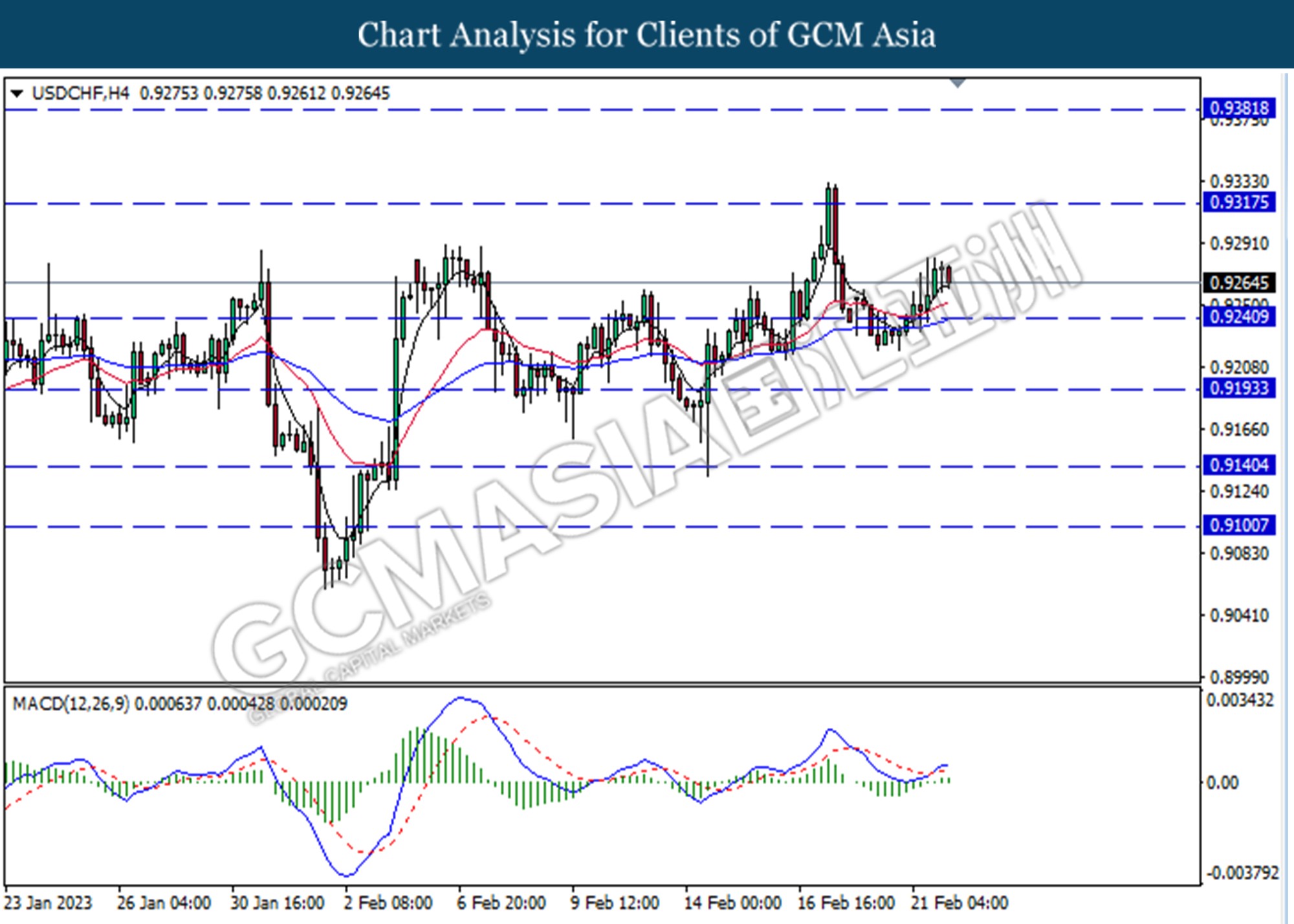

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

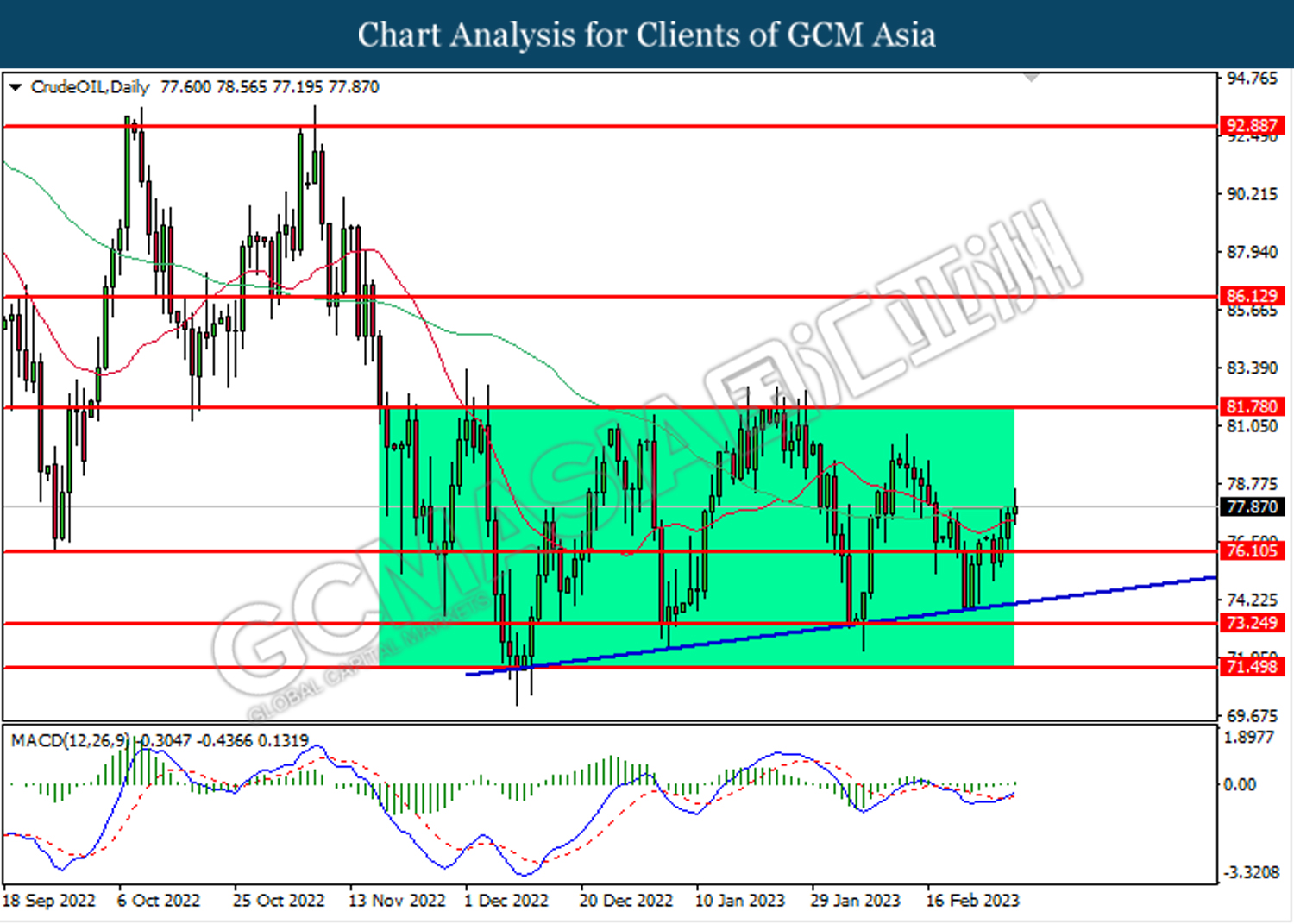

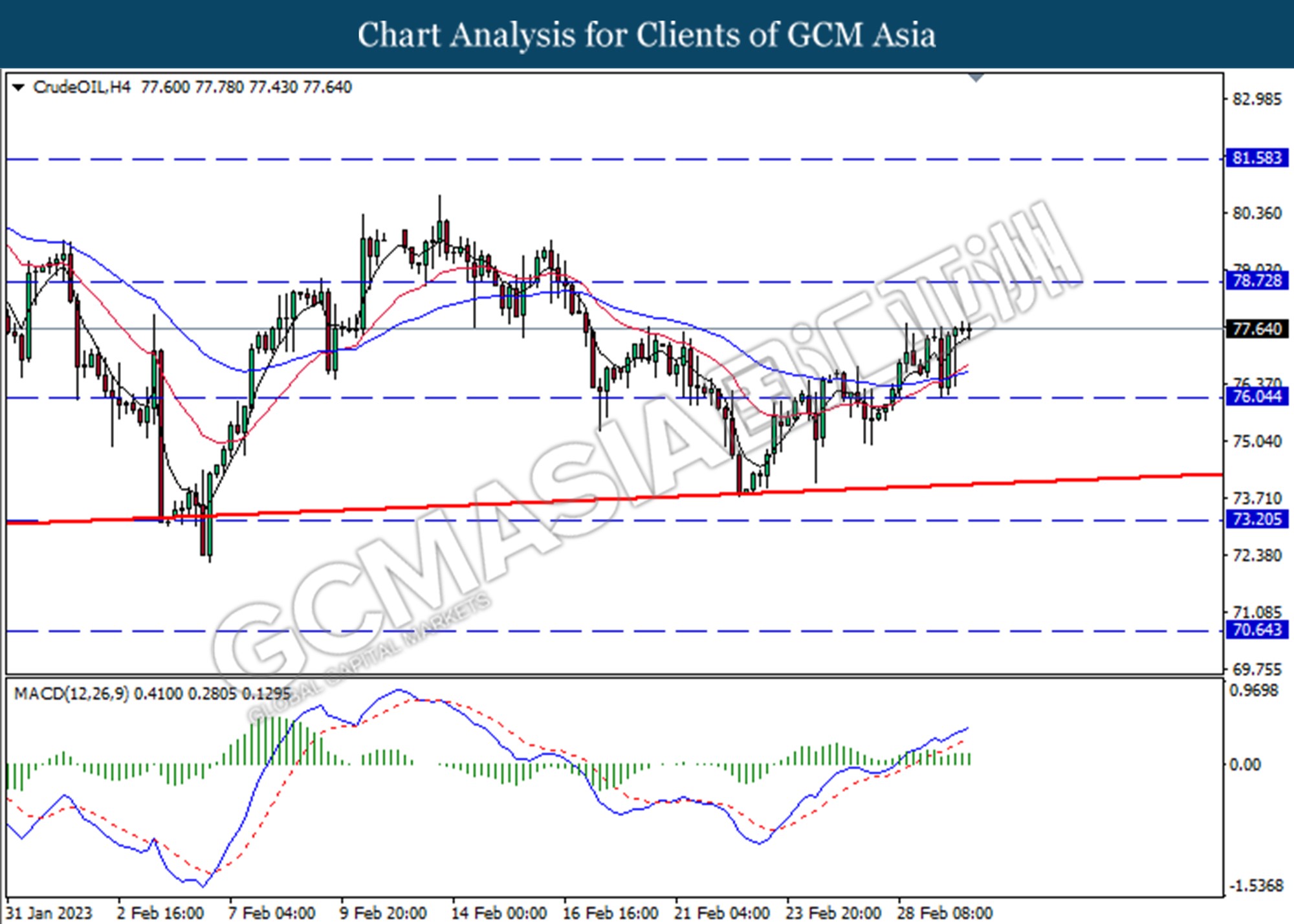

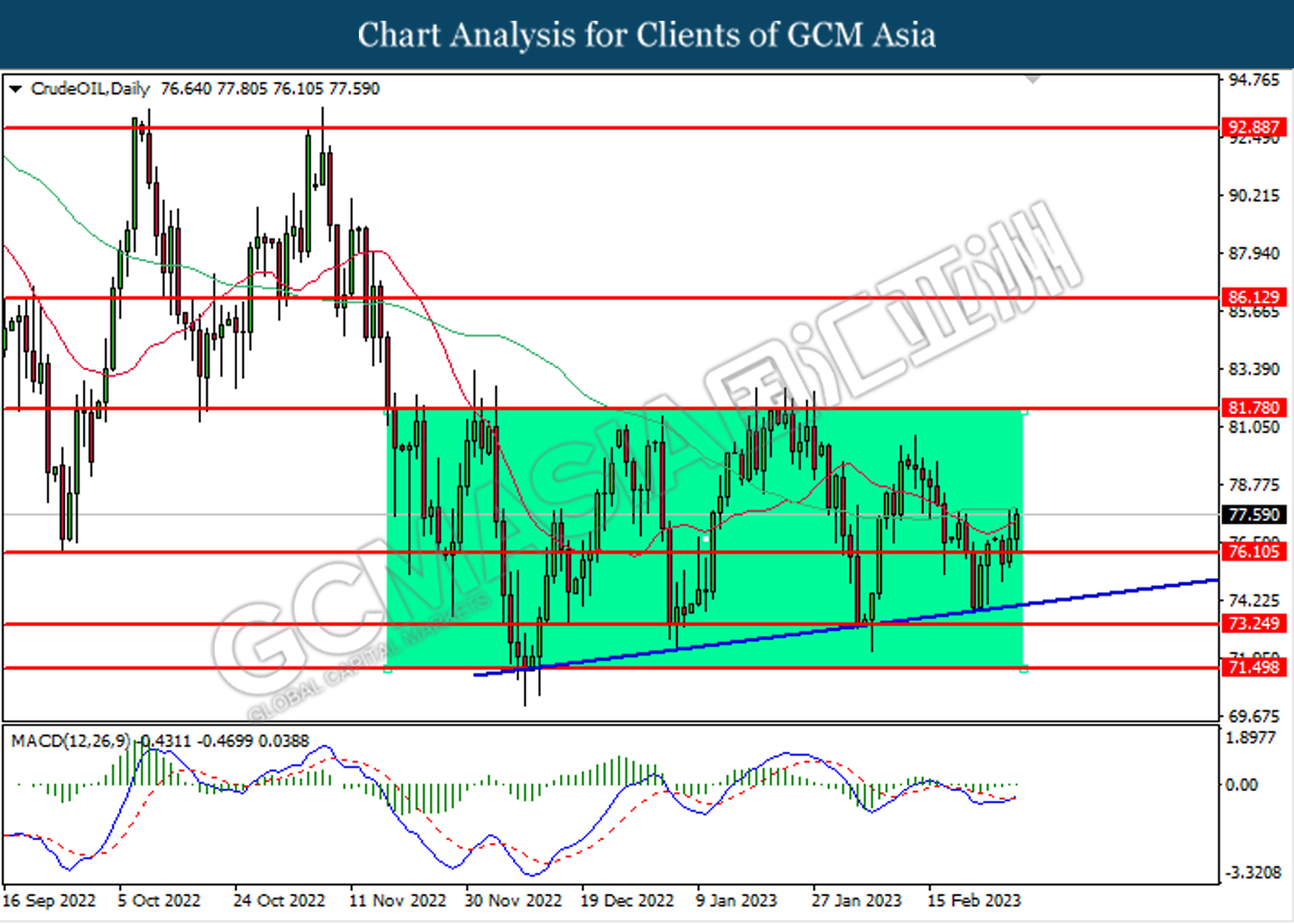

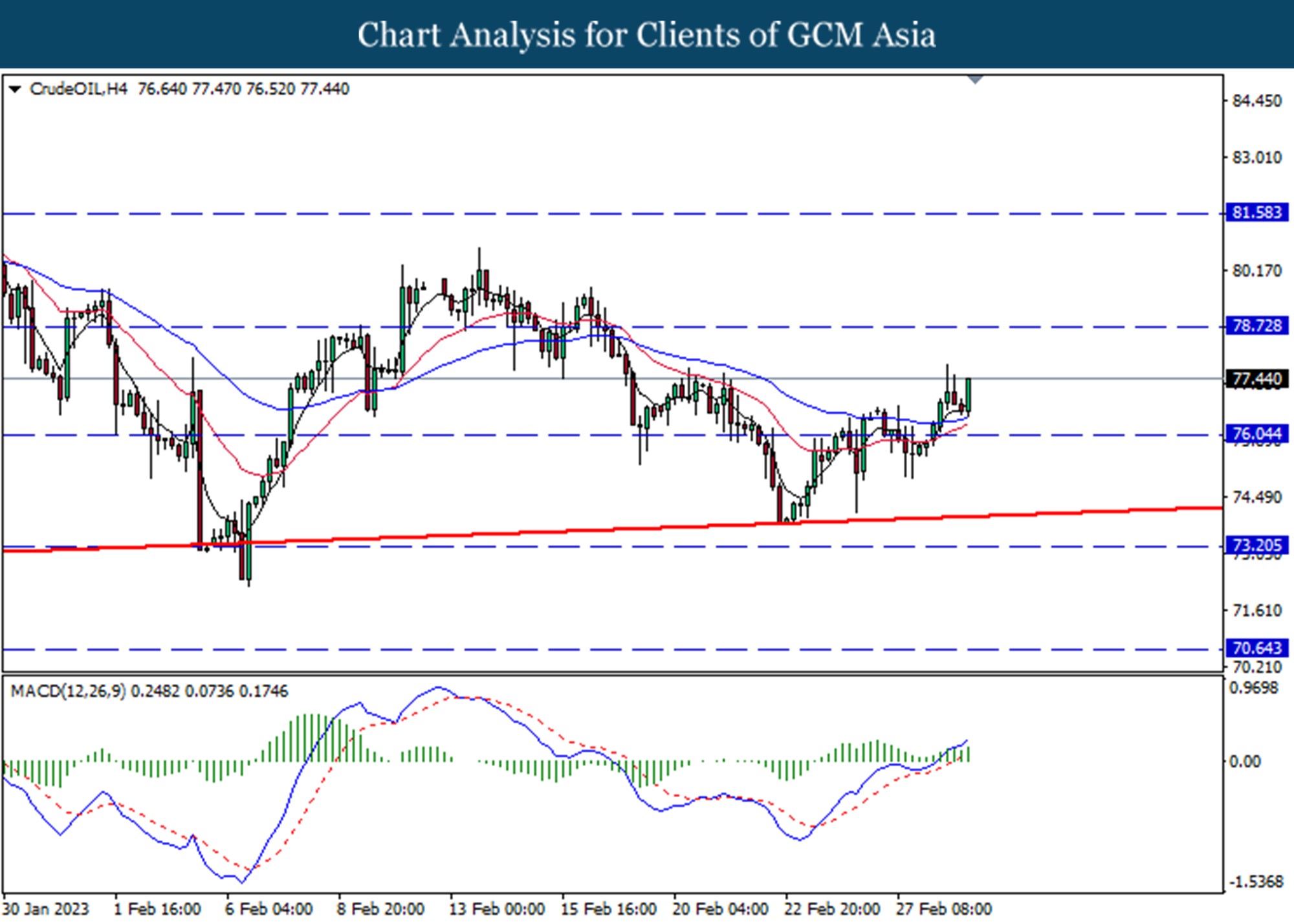

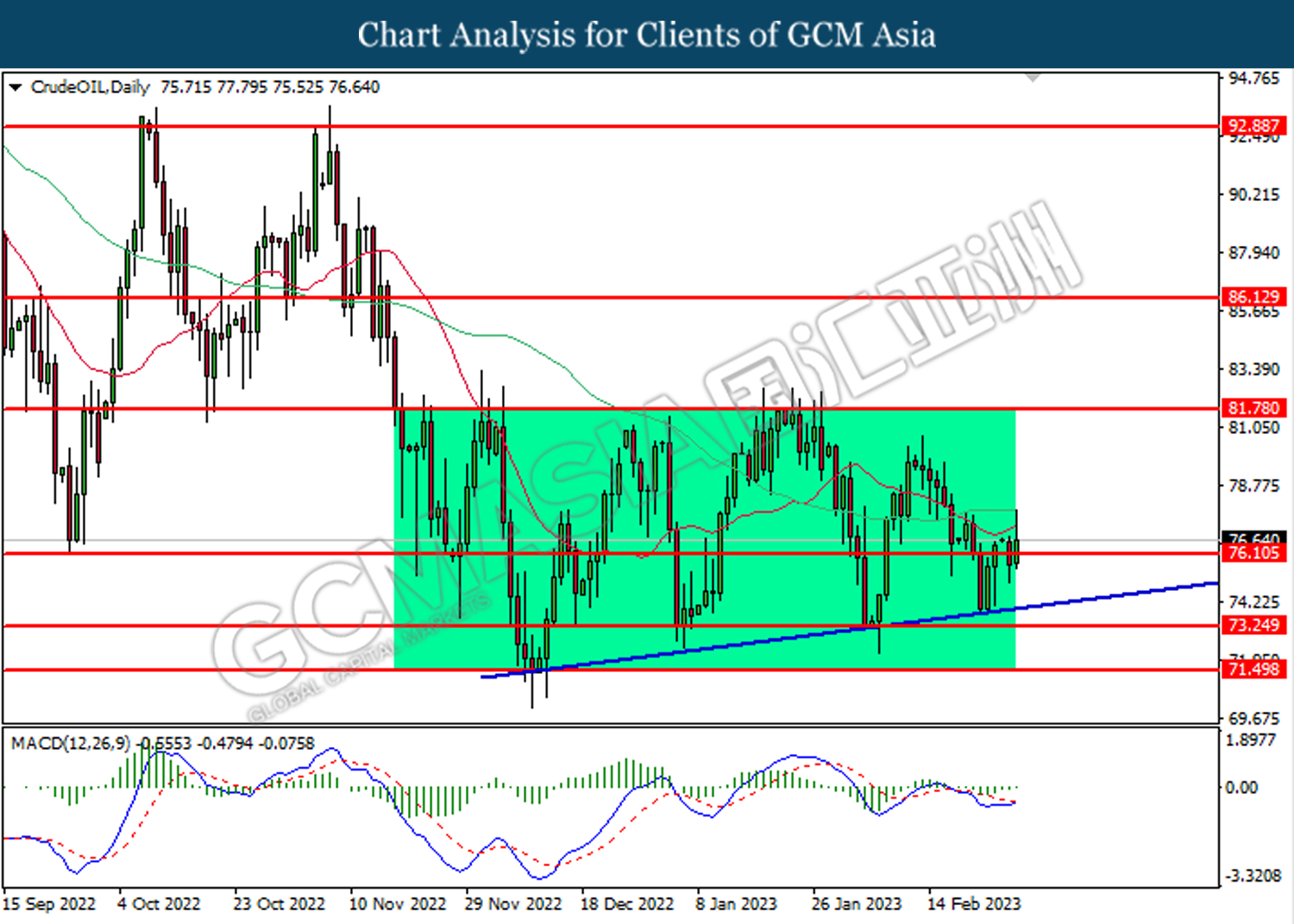

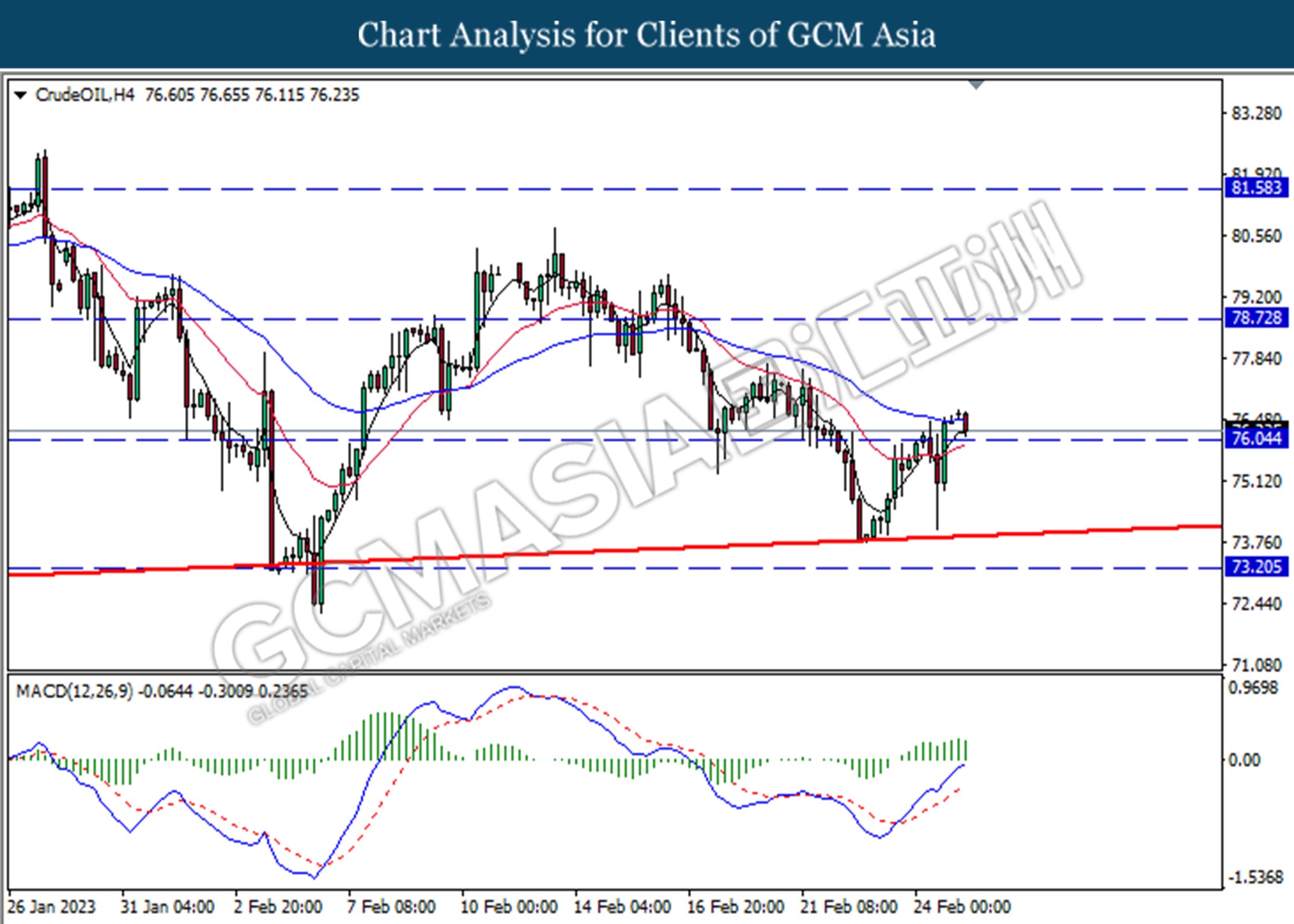

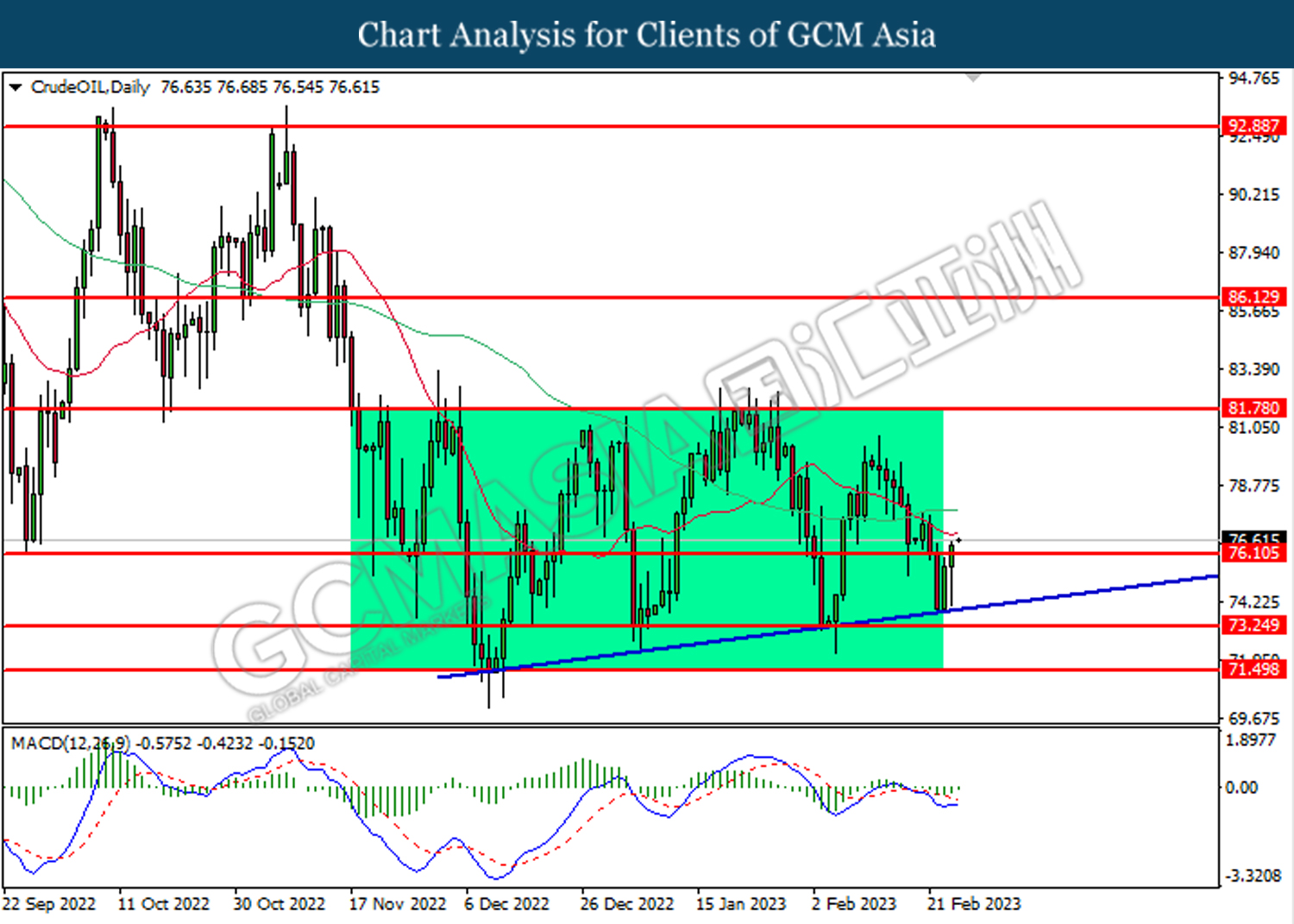

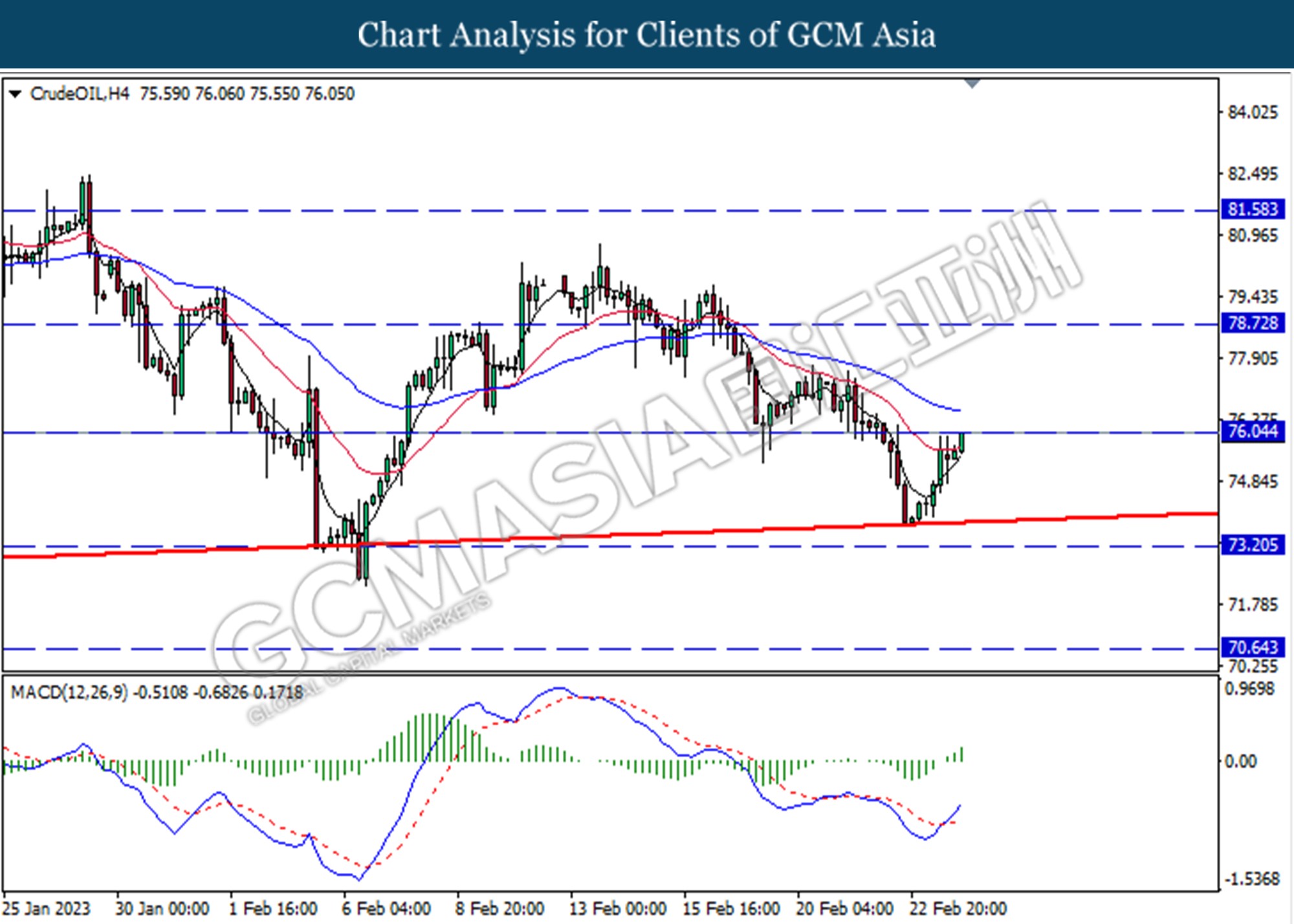

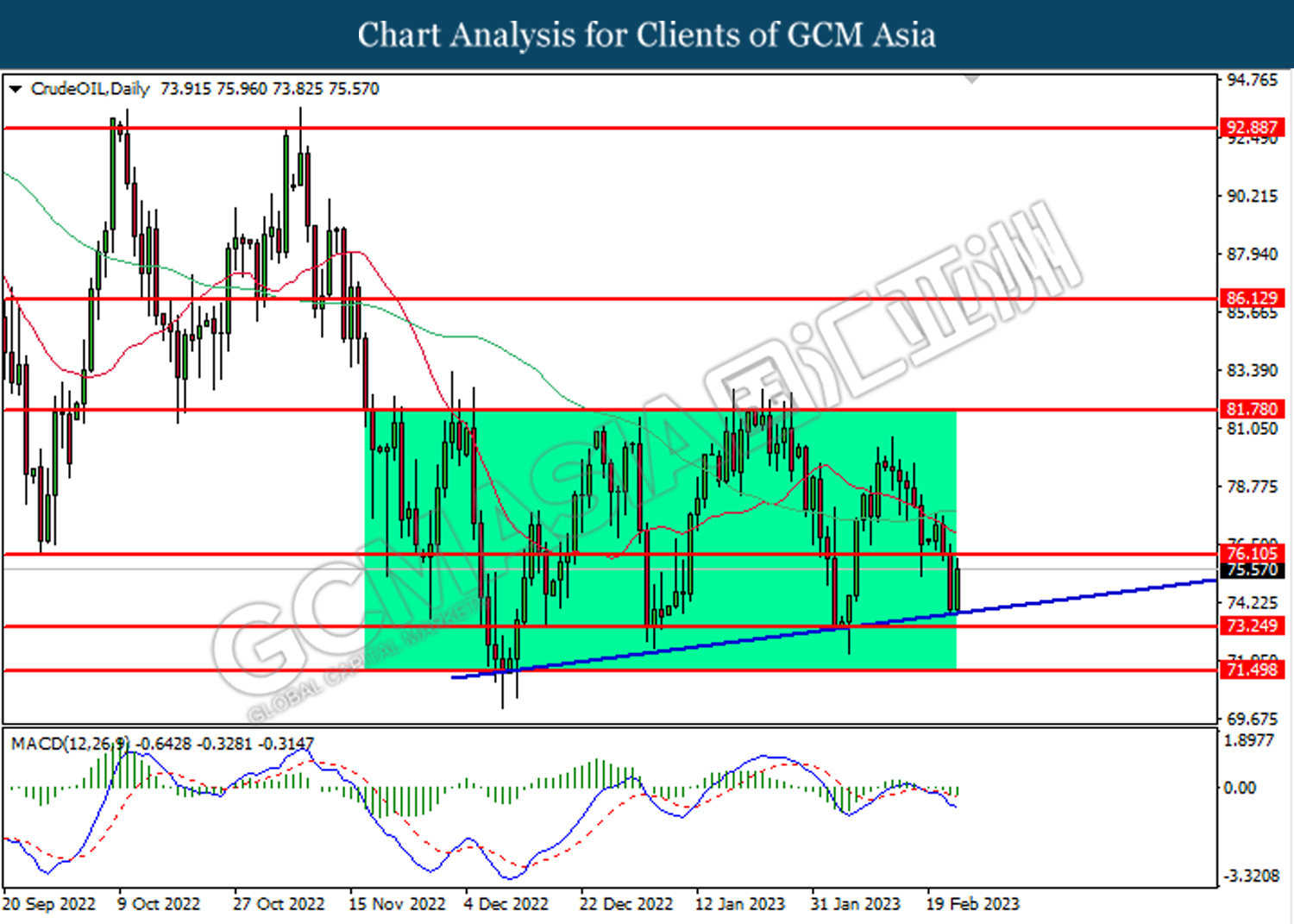

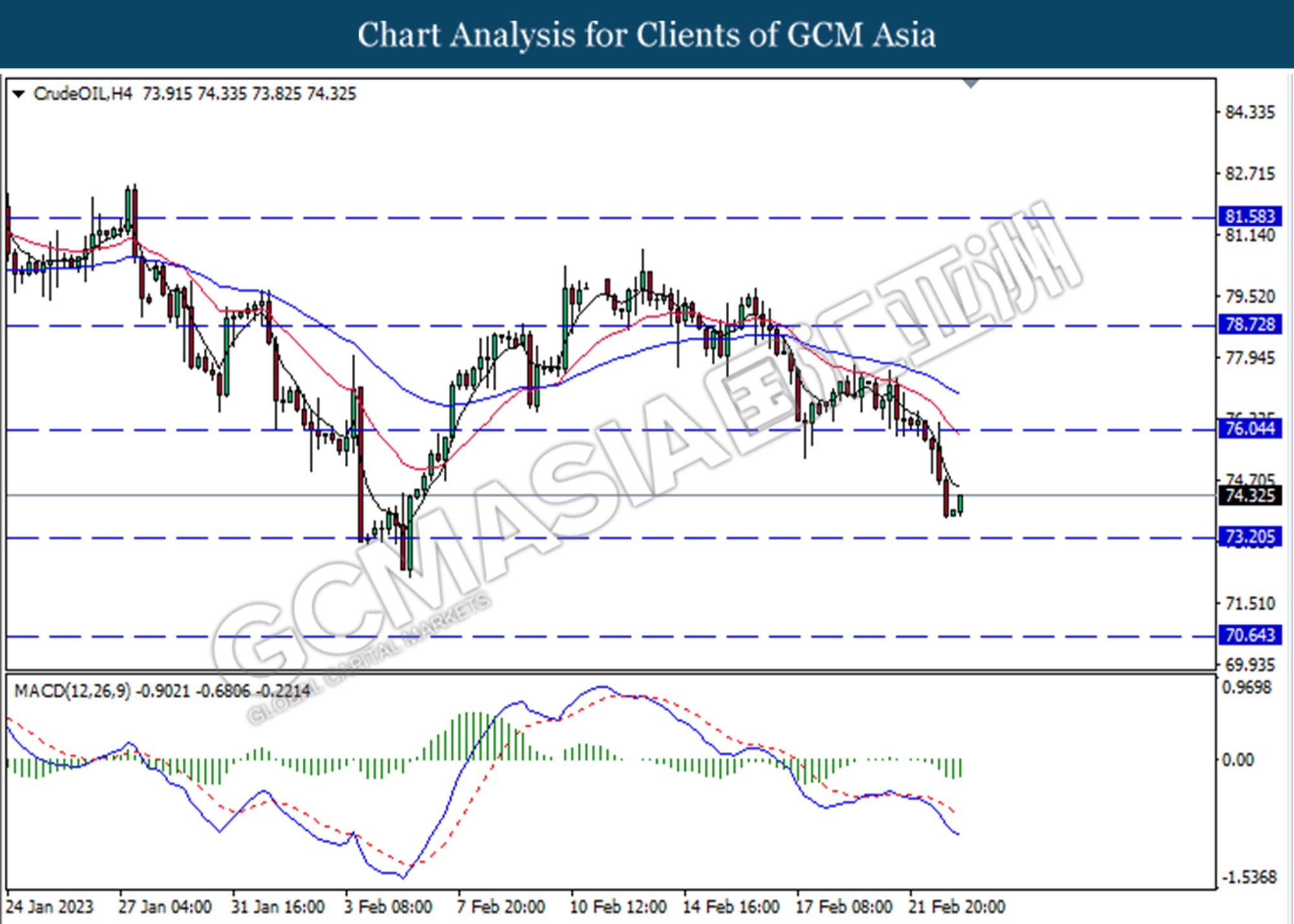

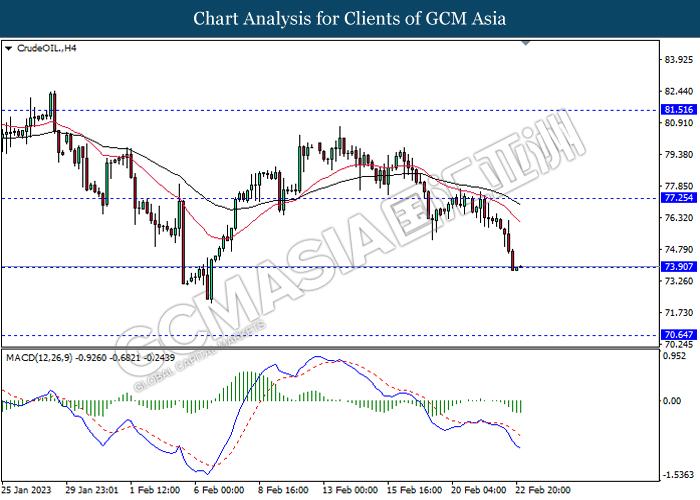

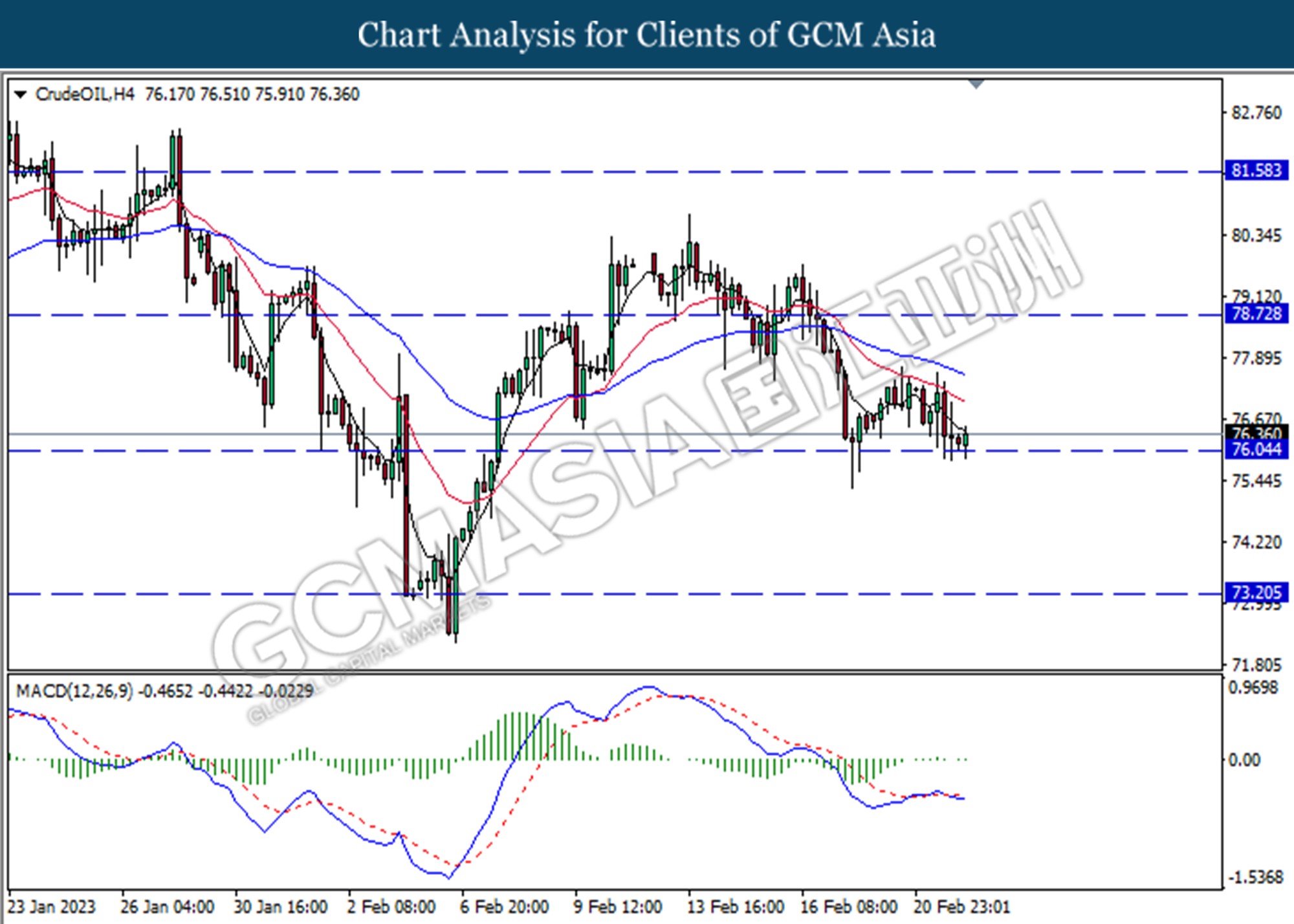

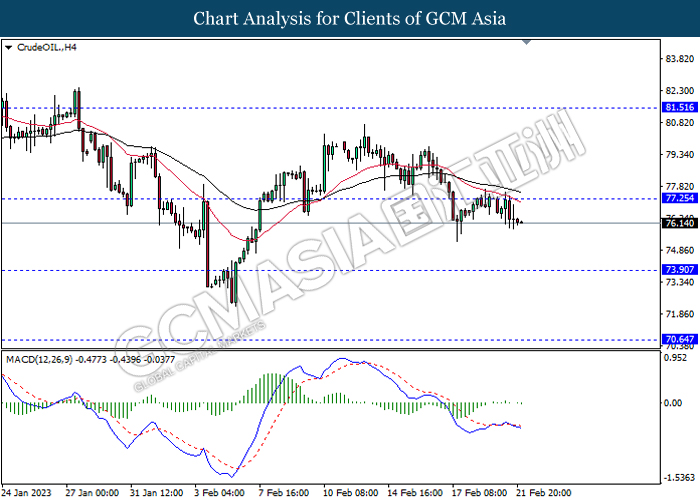

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the next resistance level.

Resistance level: 81.80, 86.15

Support level: 76.10, 73.25

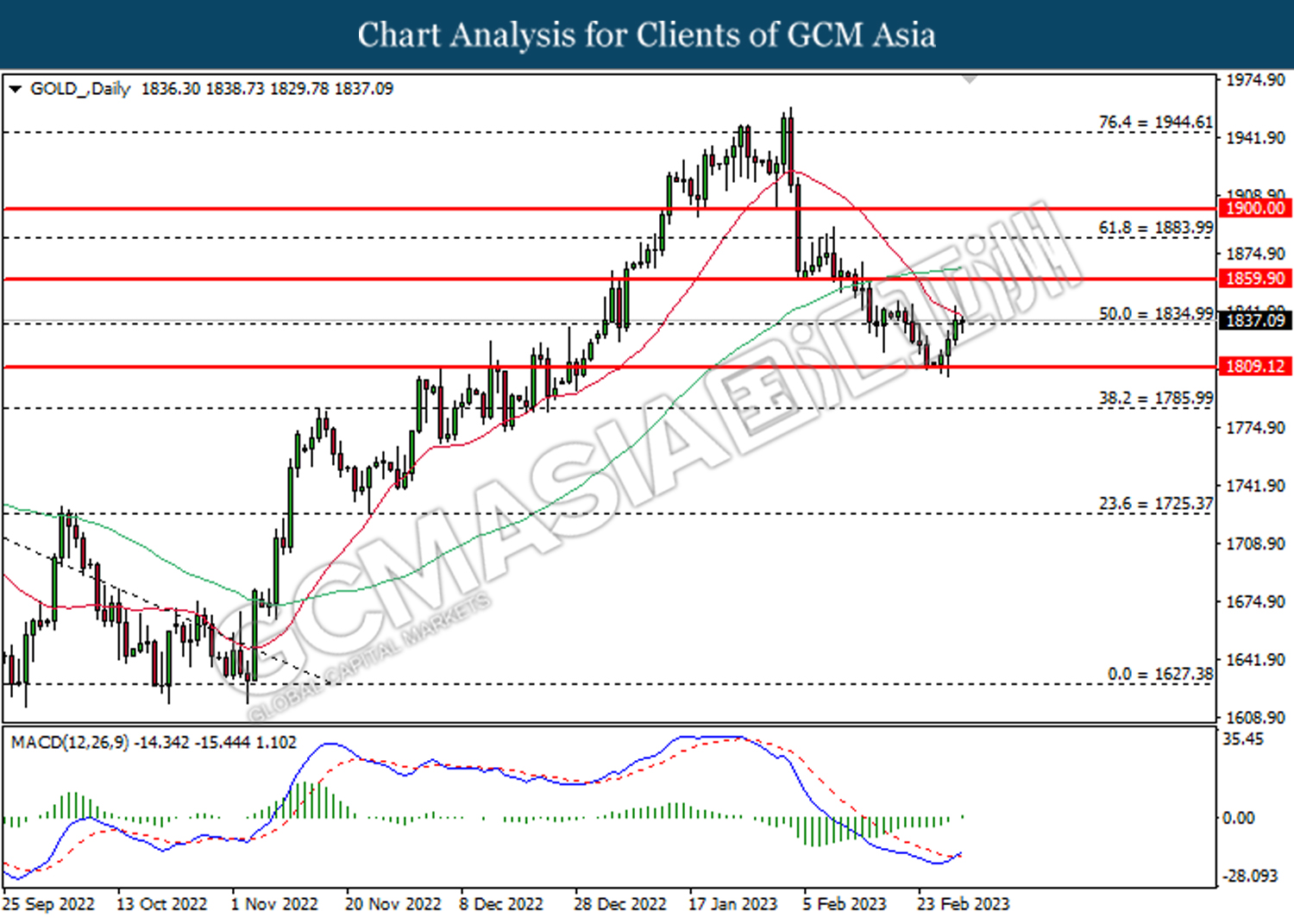

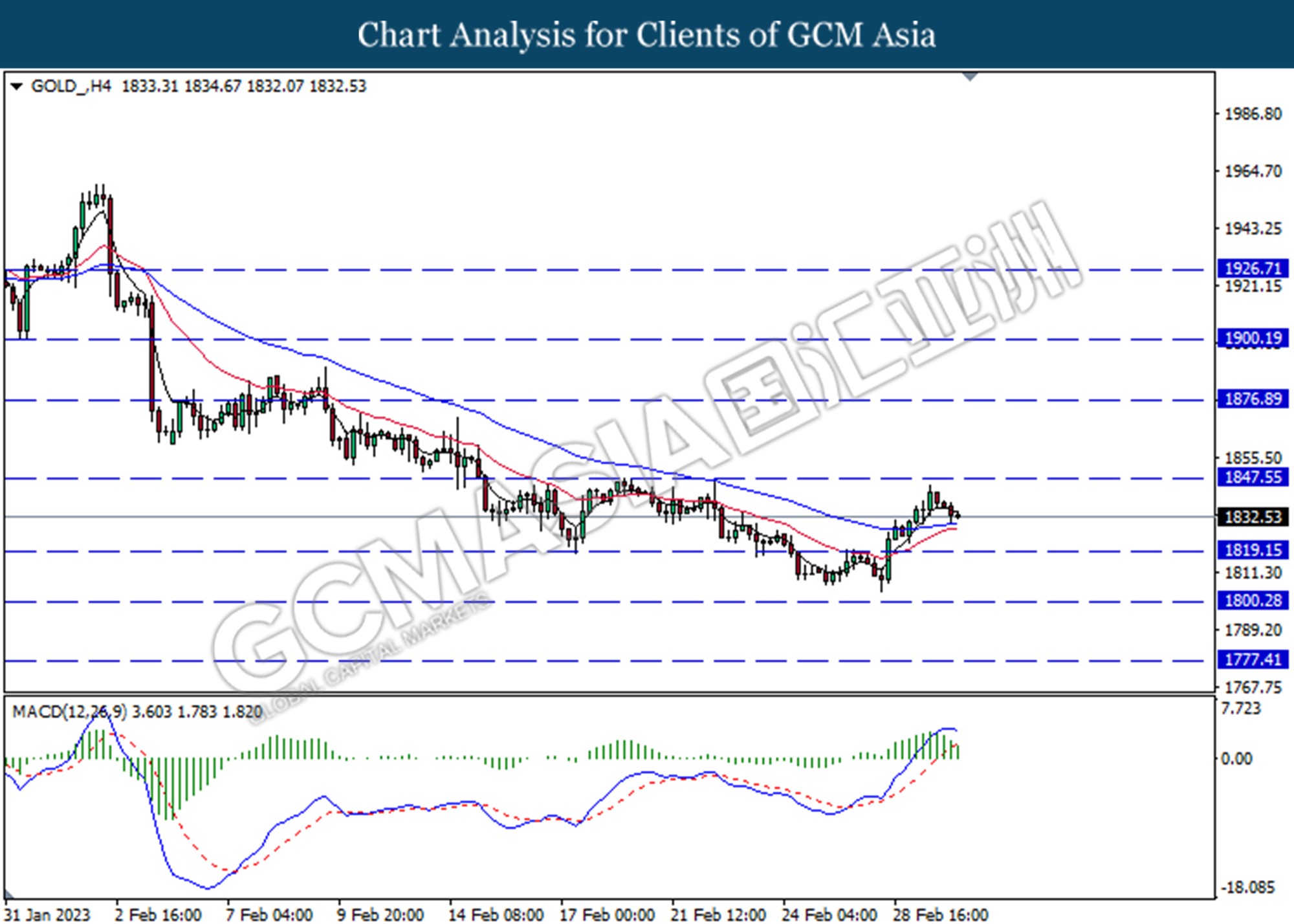

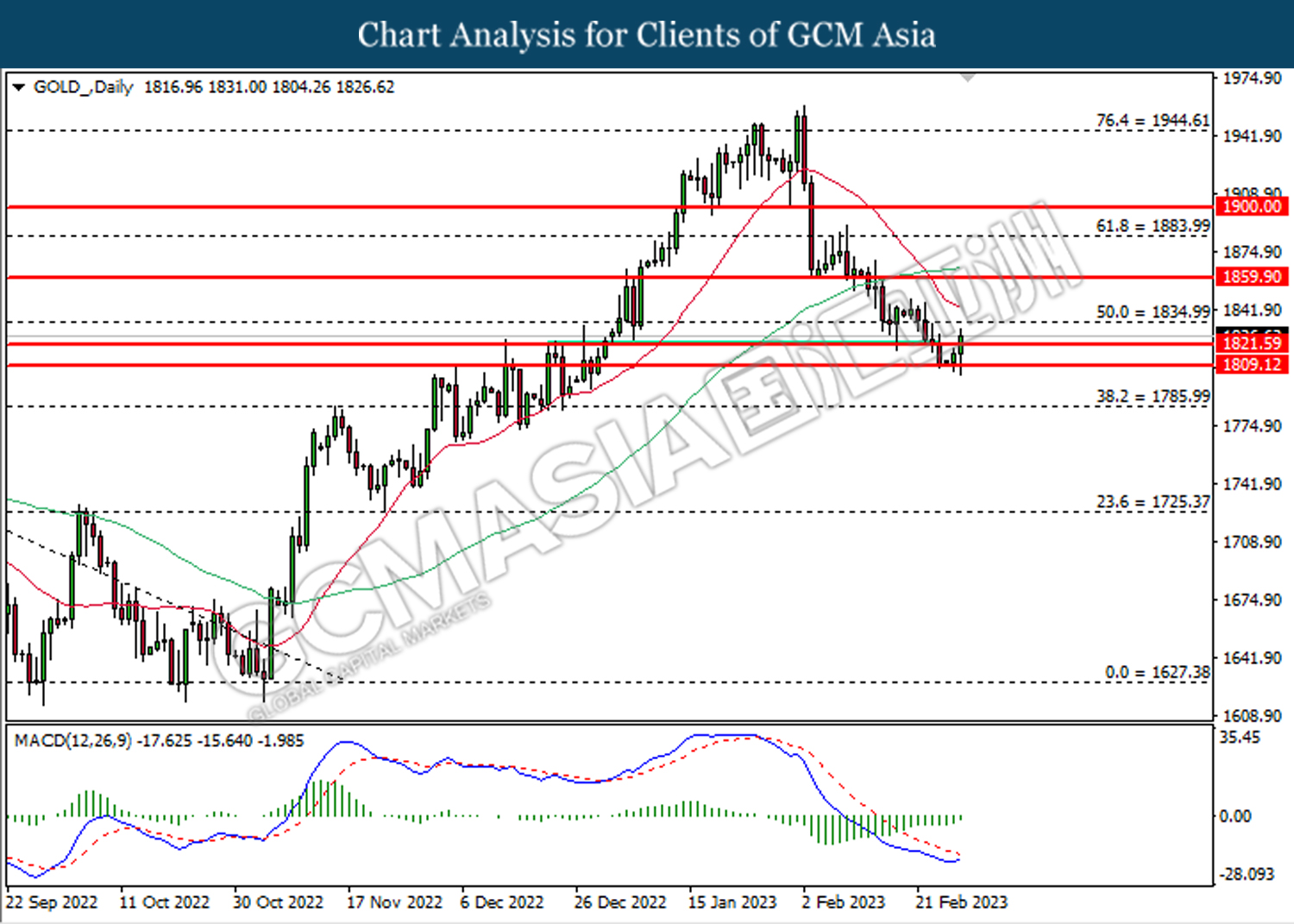

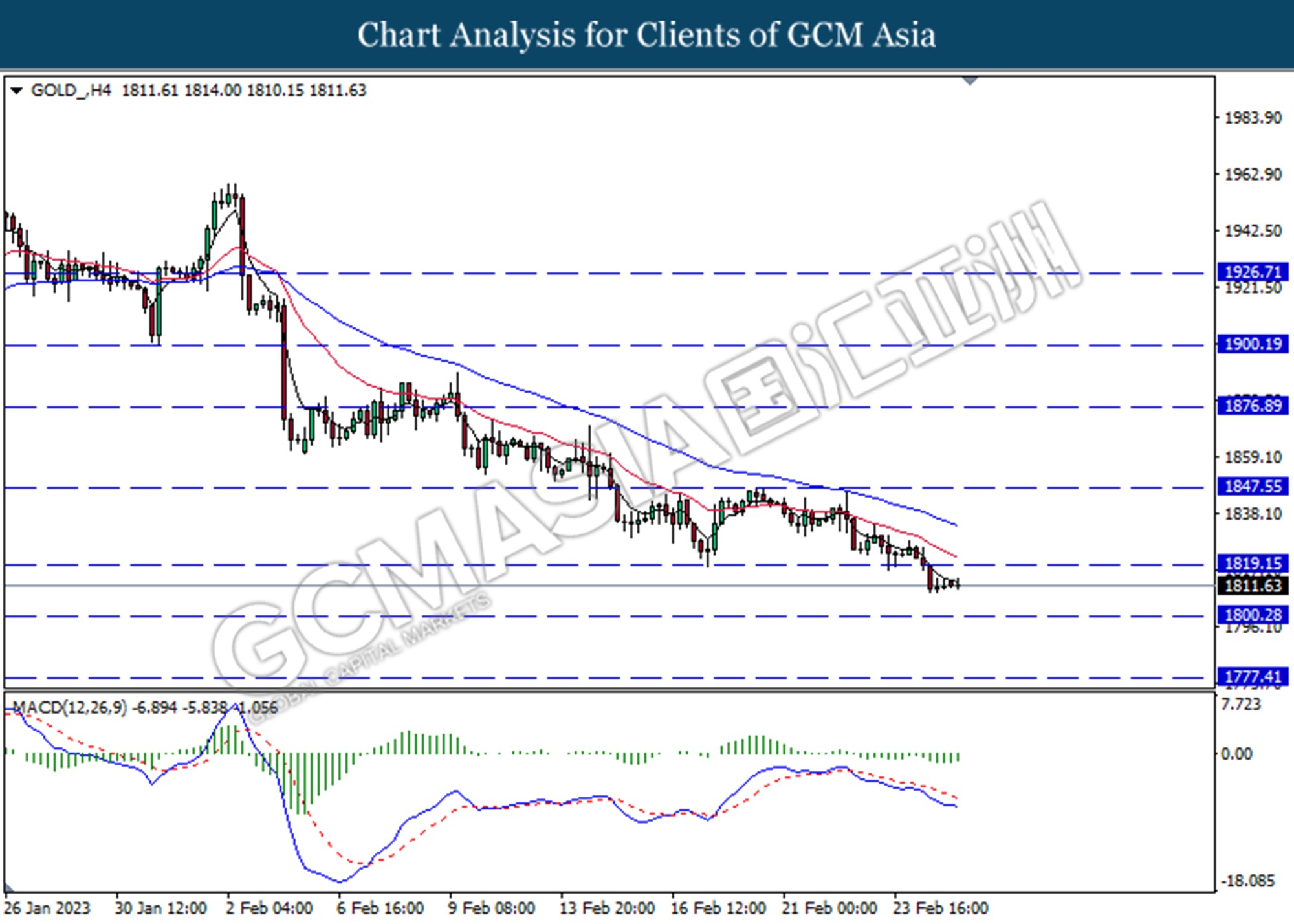

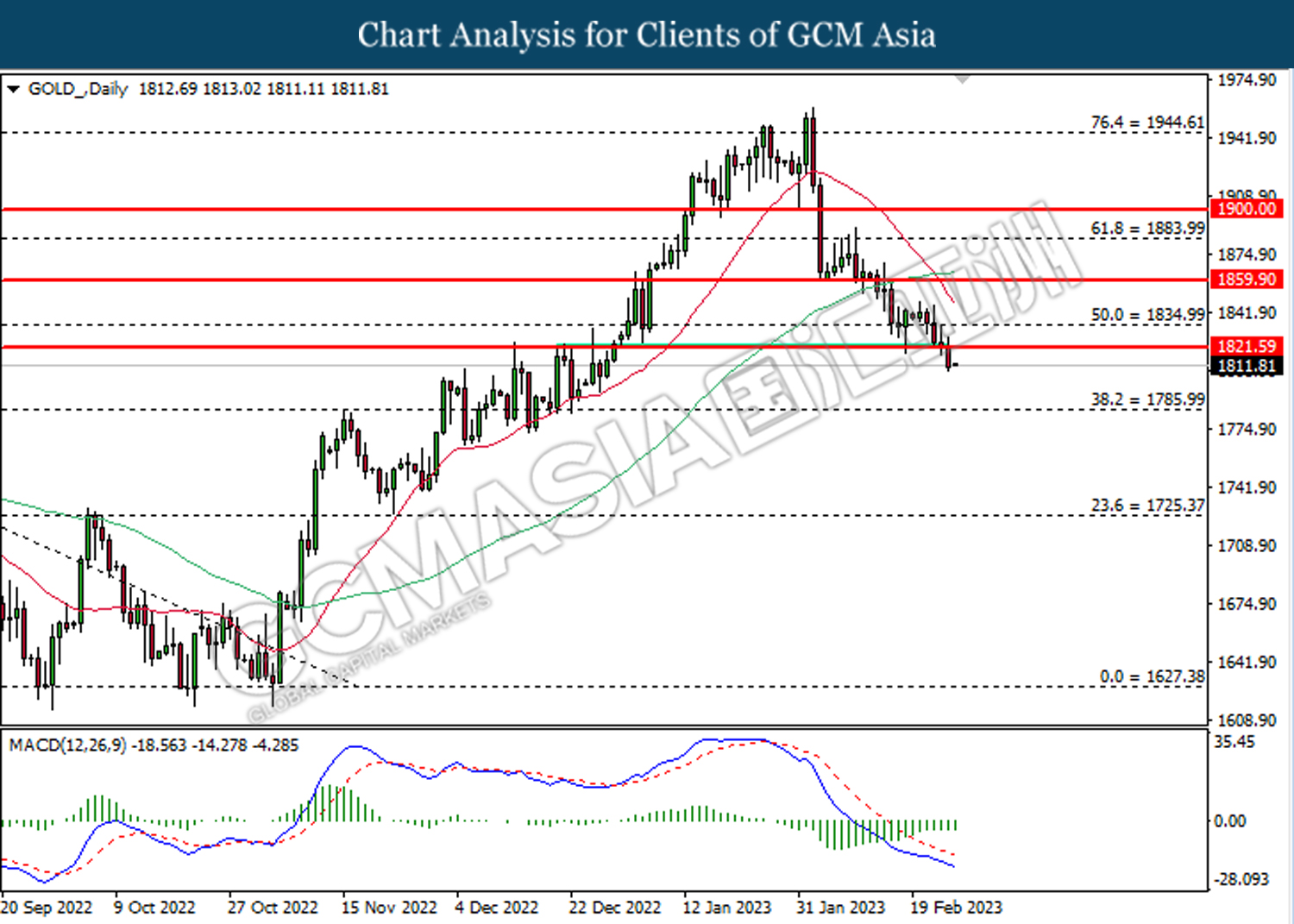

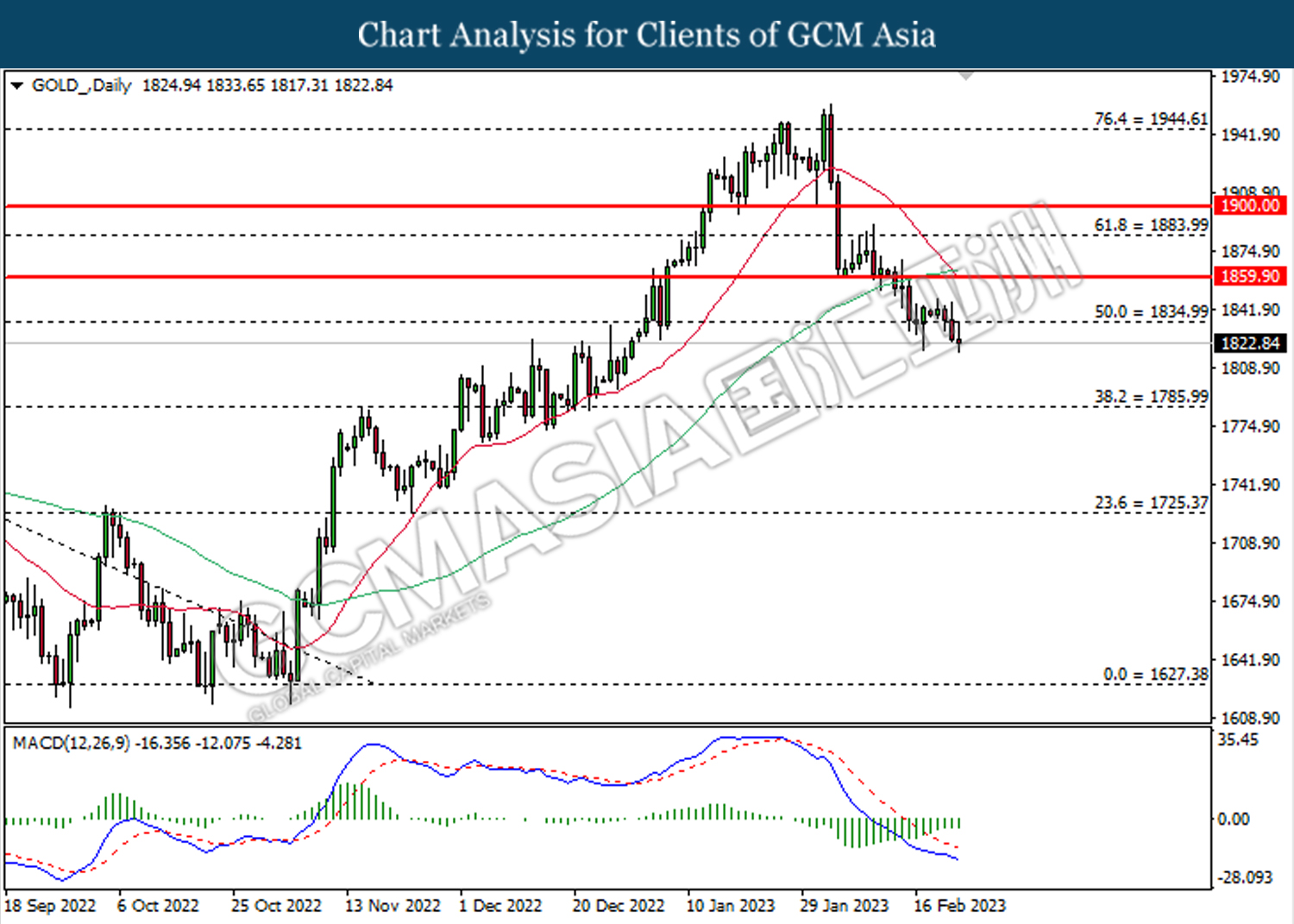

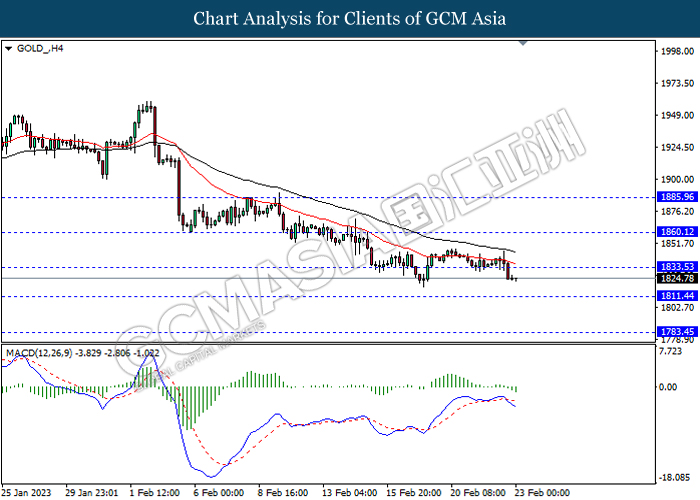

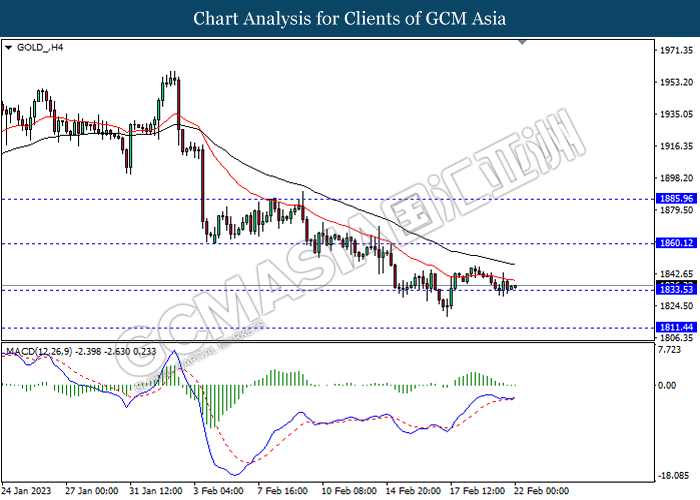

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1835.00 MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1835.00.

Resistance level: 1835.00, 1859.90

Support level: 1809.10, 1786.00

020323 Afternoon Session Analysis

02 March 2023 Afternoon Session Analysis

EUR lifted after German inflation data.

The EUR/USD pair was lifted on Wednesday following the release of higher-than-expected German inflation data. According to the federal statistic agency Destatis’s data released on Wednesday, the German CPI annual reading held steady at 8.7%, similar to the reading in January. The high inflation figure was attributed to the rise in energy prices and tight labor market conditions in Germany. The labor market condition in German remained unchanged at 5.5%, but the number of unemployed people increased by 2k, lower than the market expectation of 9k. In addition, inflation in France and Spain rose to 6.2% and 6.1% respectively, due to rising energy prices. The inflation remained at a high level, and well above the European Central Bank’s (ECB) 2% target. Therefore, the euro strengthened with the expectation that ECB will continue tightening its monetary policy, such as hiking its interest rate further by 50 basis points. Apart from this, investors are focusing on Eurozone February’s inflation data, which will be published by Eurostat later today. At this point of time, investors expect the reading will slow down to 8.2%, lower than the previous reading’s 8.6%. As of writing, the EUR/USD slipped by -0.14% to $1.0650 as investors awaited more cues from the upcoming inflation figure.

In the commodities market, crude oil prices edged down by 0.01% to $77.69 per barrel as crude oil prices rebounded on China’s optimistic economic data released yesterday. Besides, gold prices edged down by -0.33% to $1839.25 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Feb) | 8.6% | 8.2% | – |

| 21:30 | USD – Initial Jobless Claims | 192K | 197K | – |

Technical Analysis

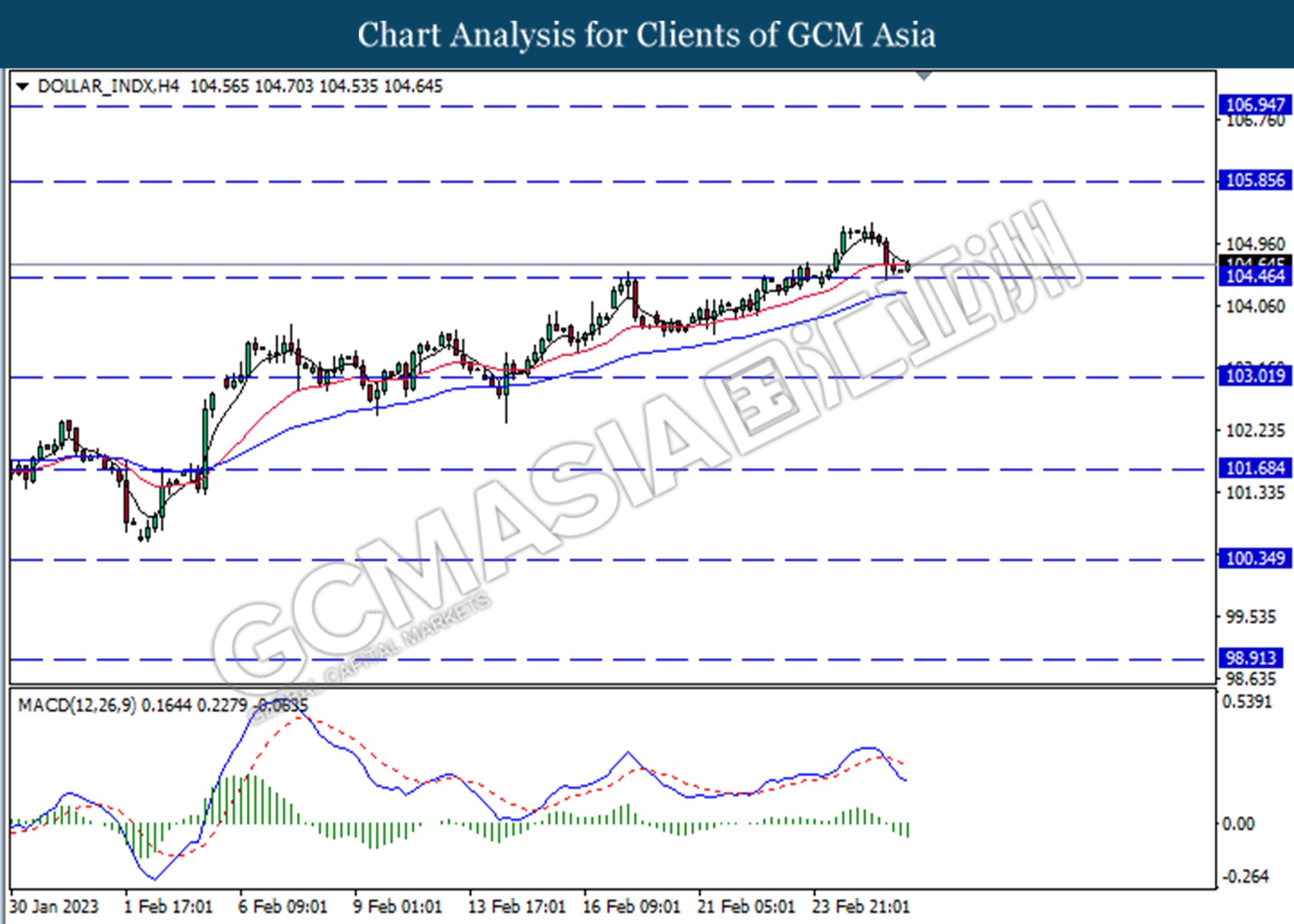

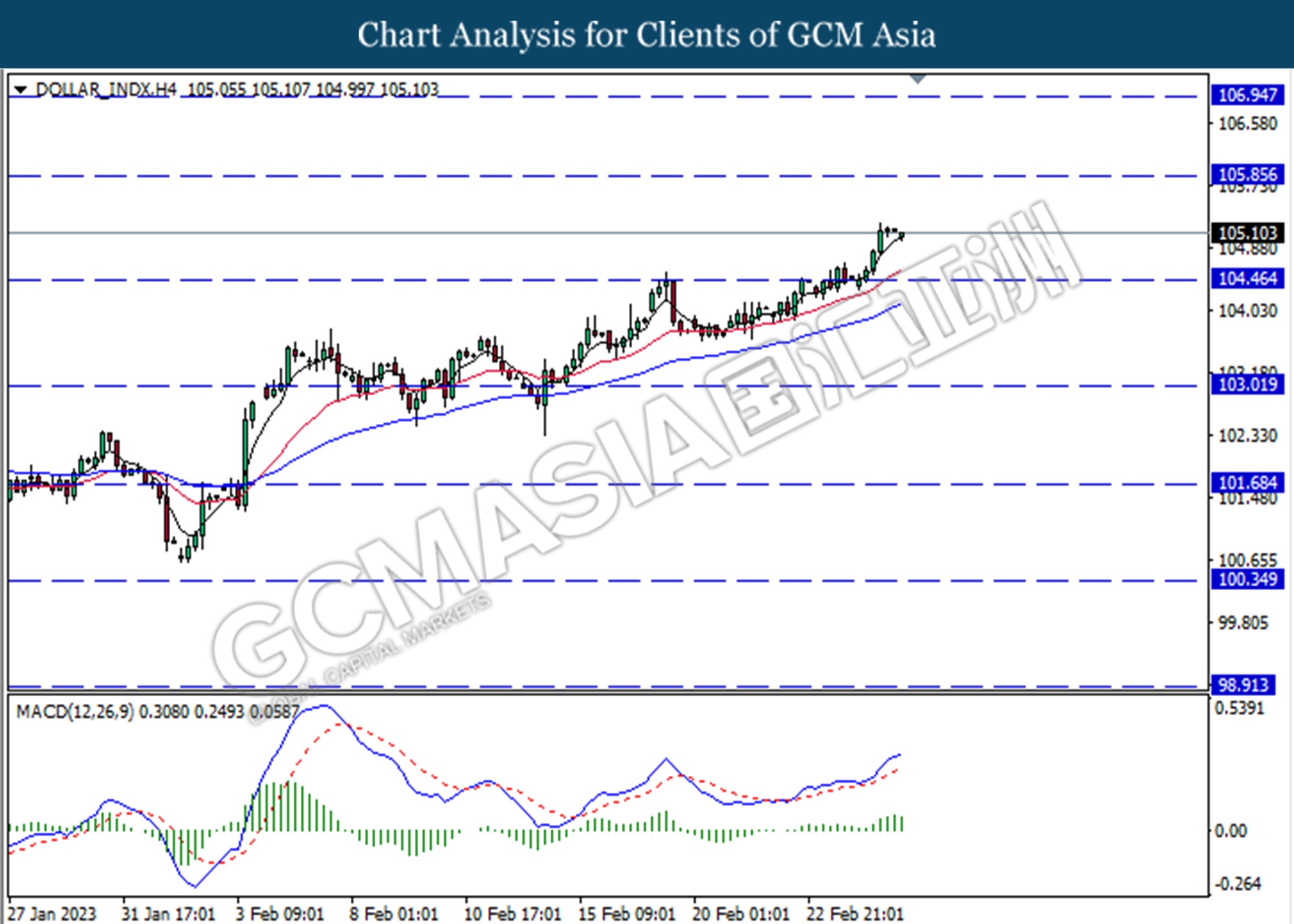

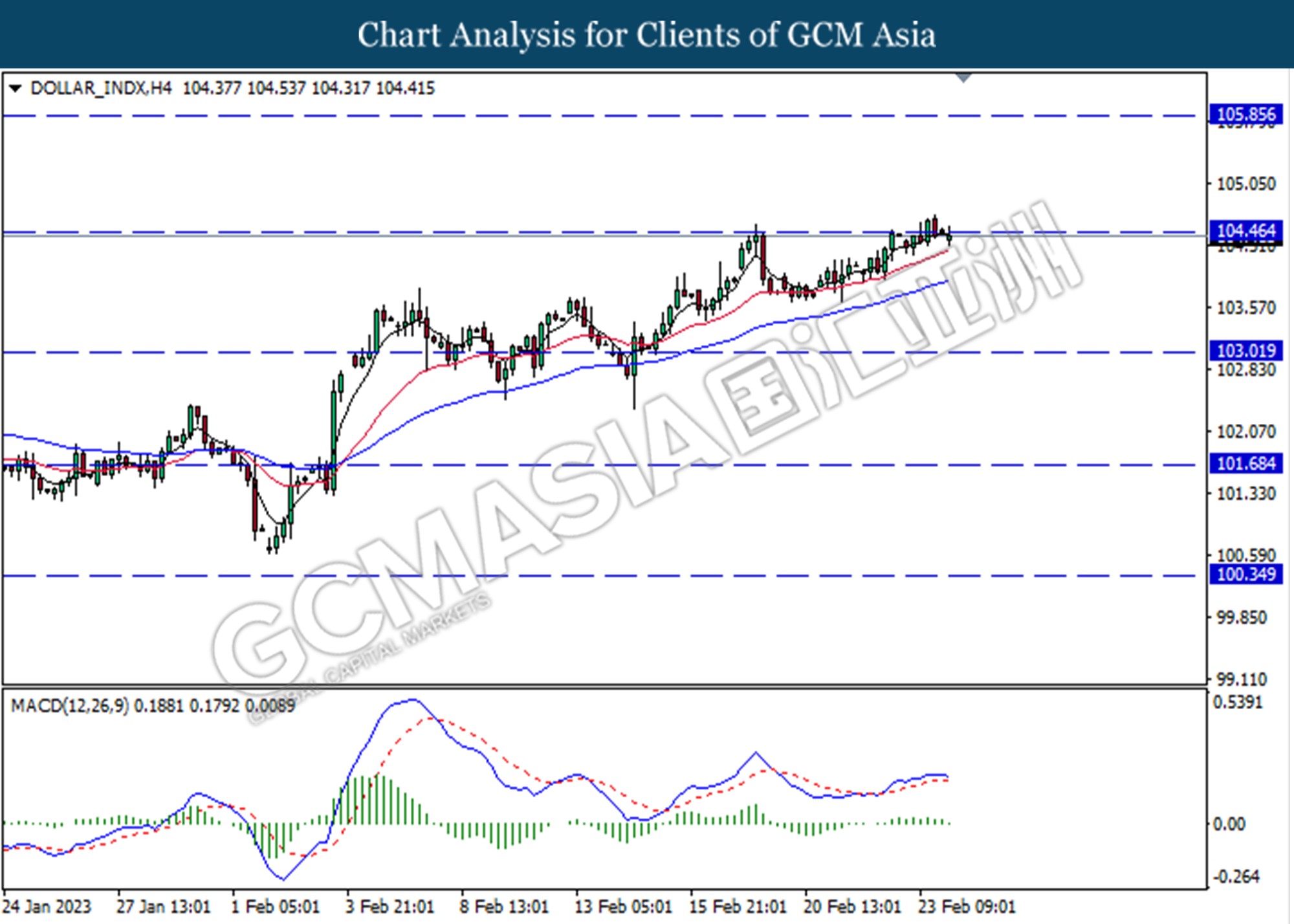

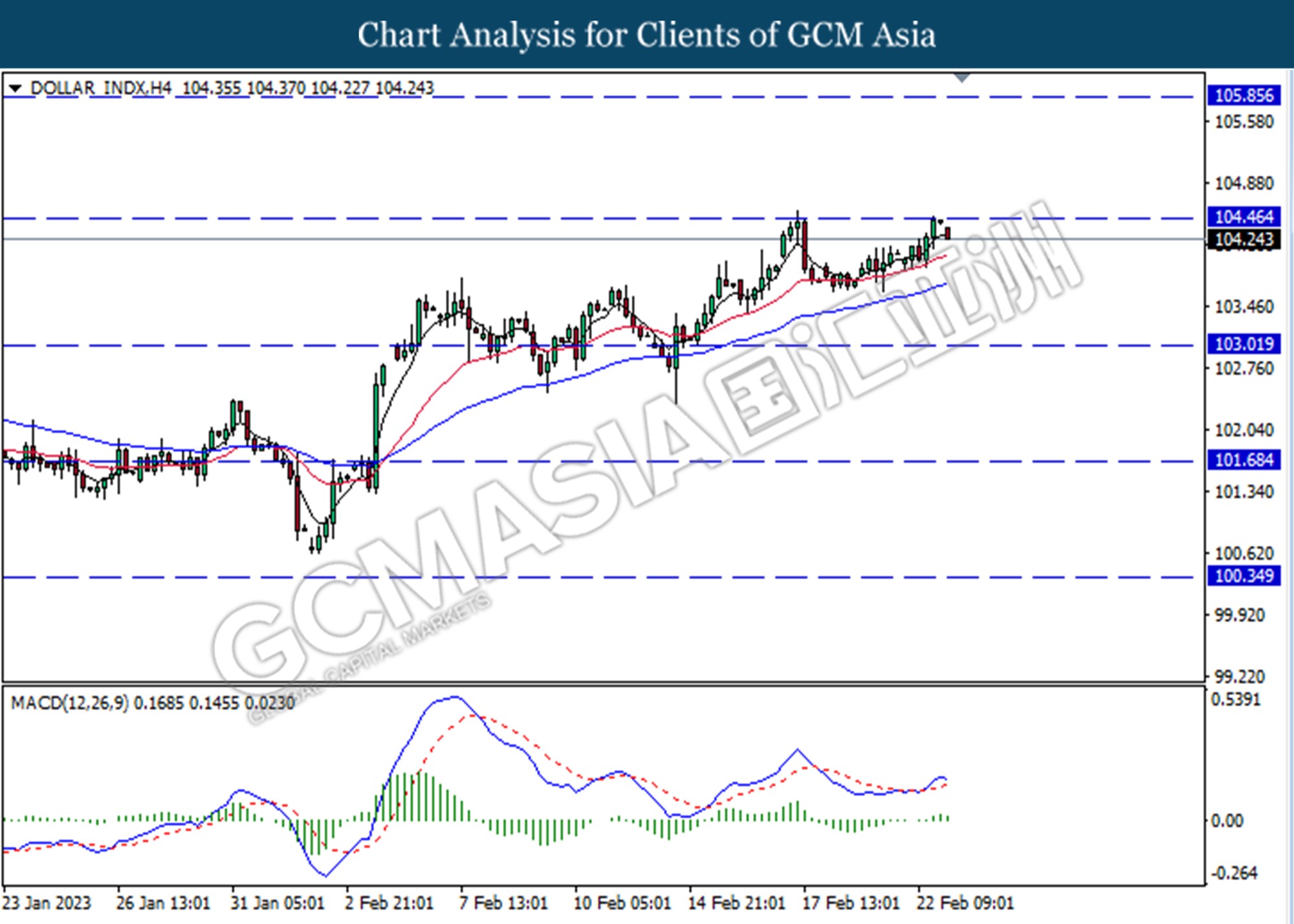

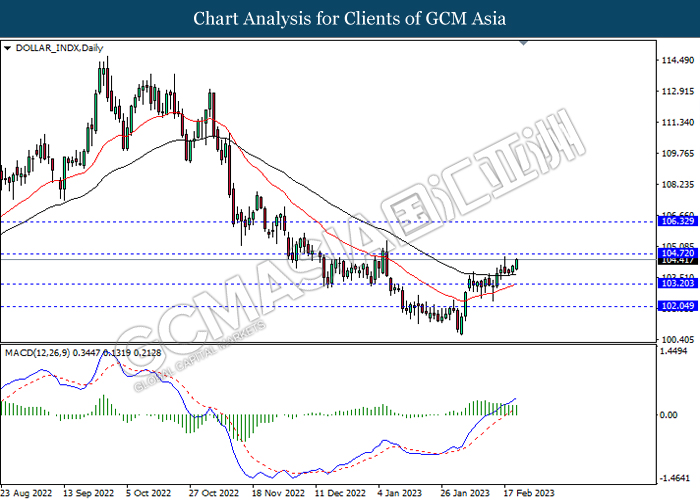

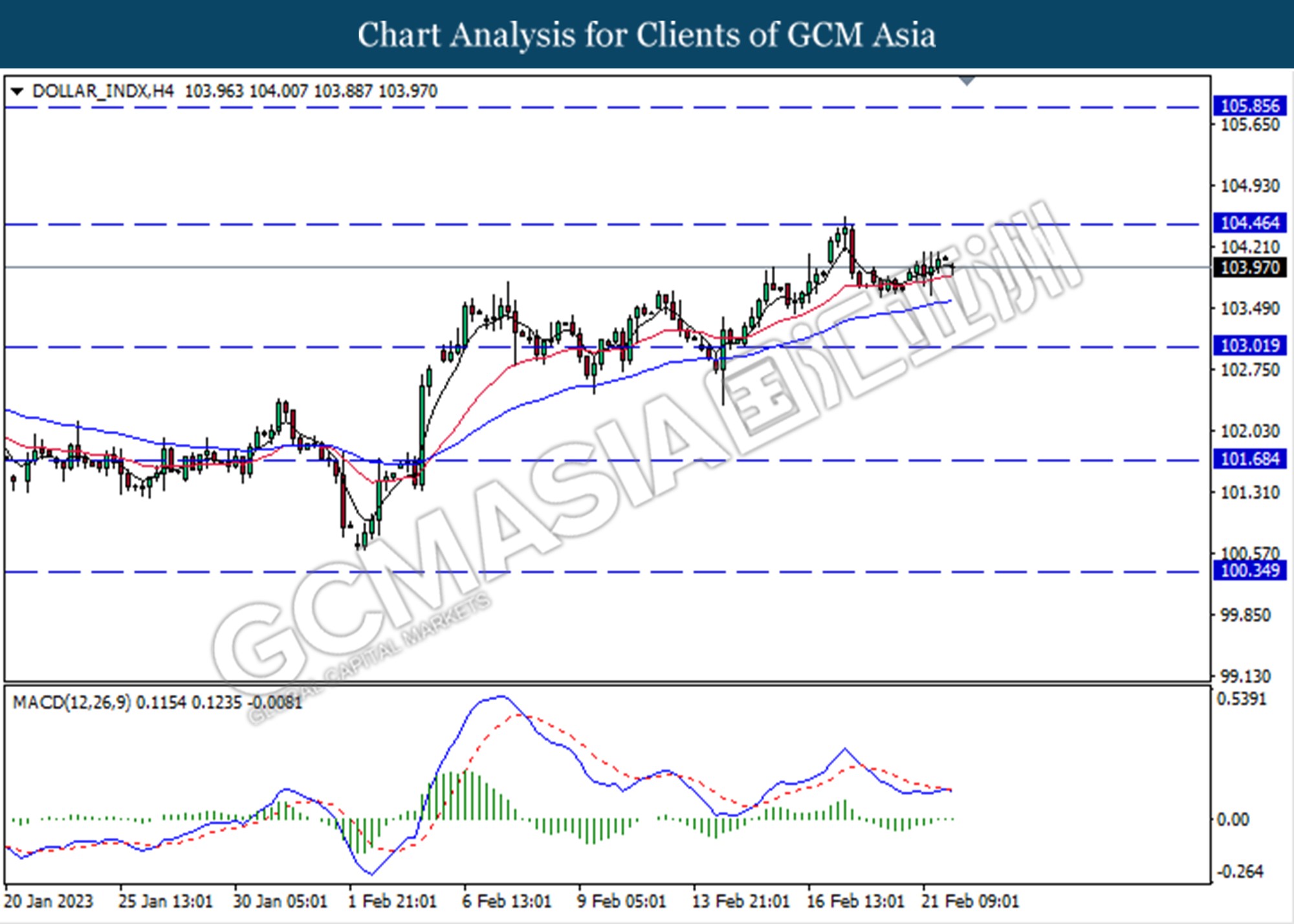

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 104.45. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains if successfully breaks above the resistance level.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

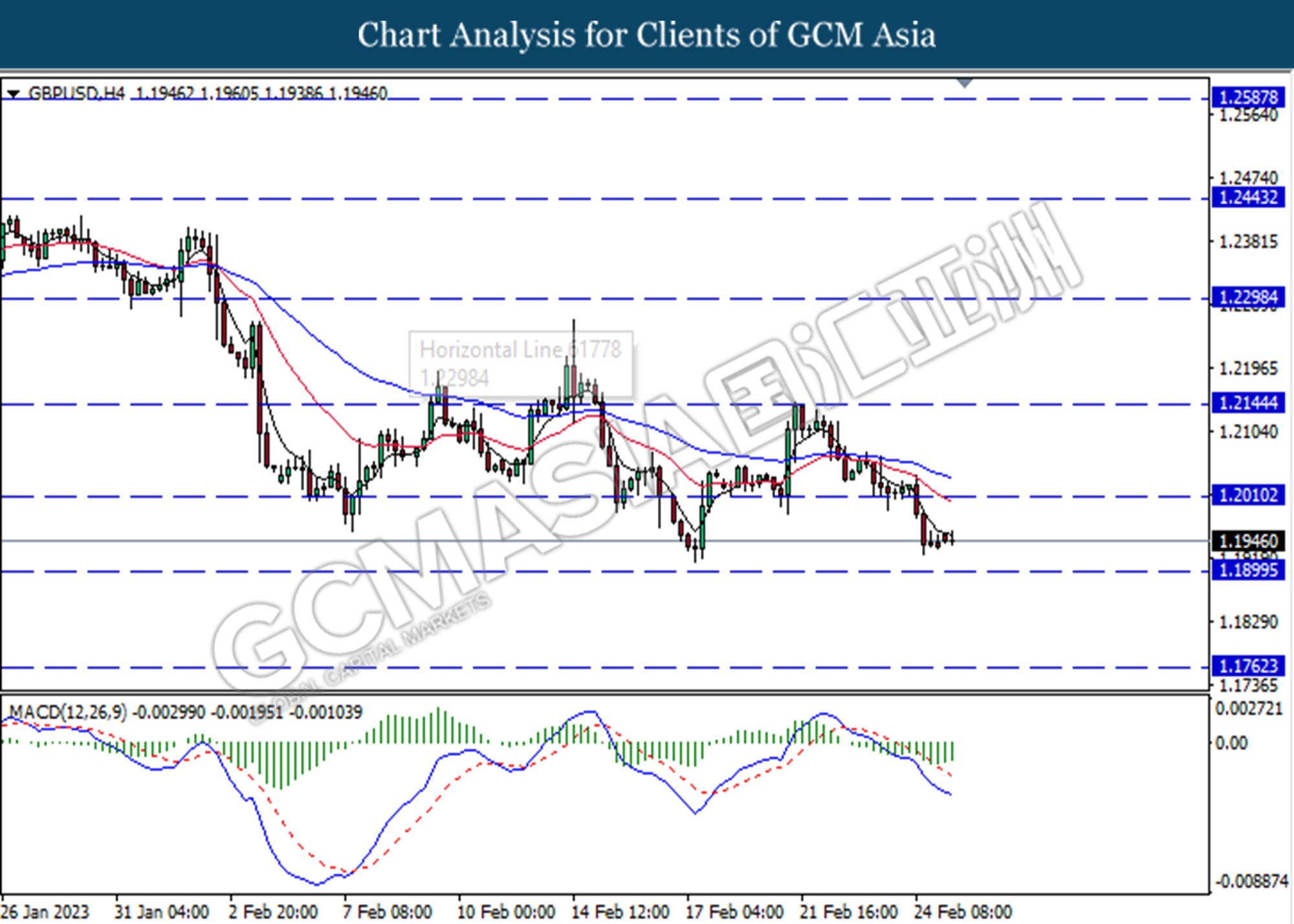

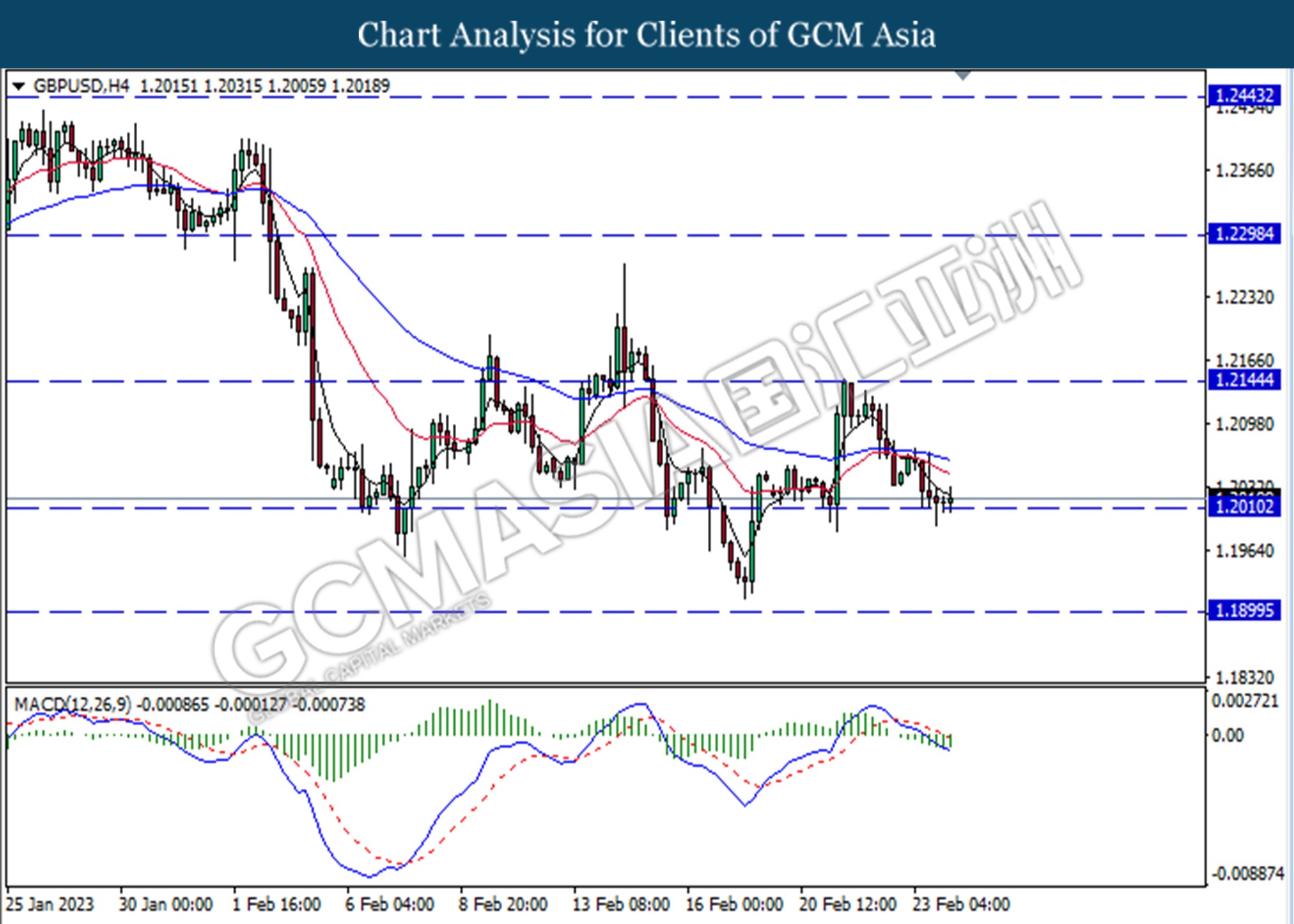

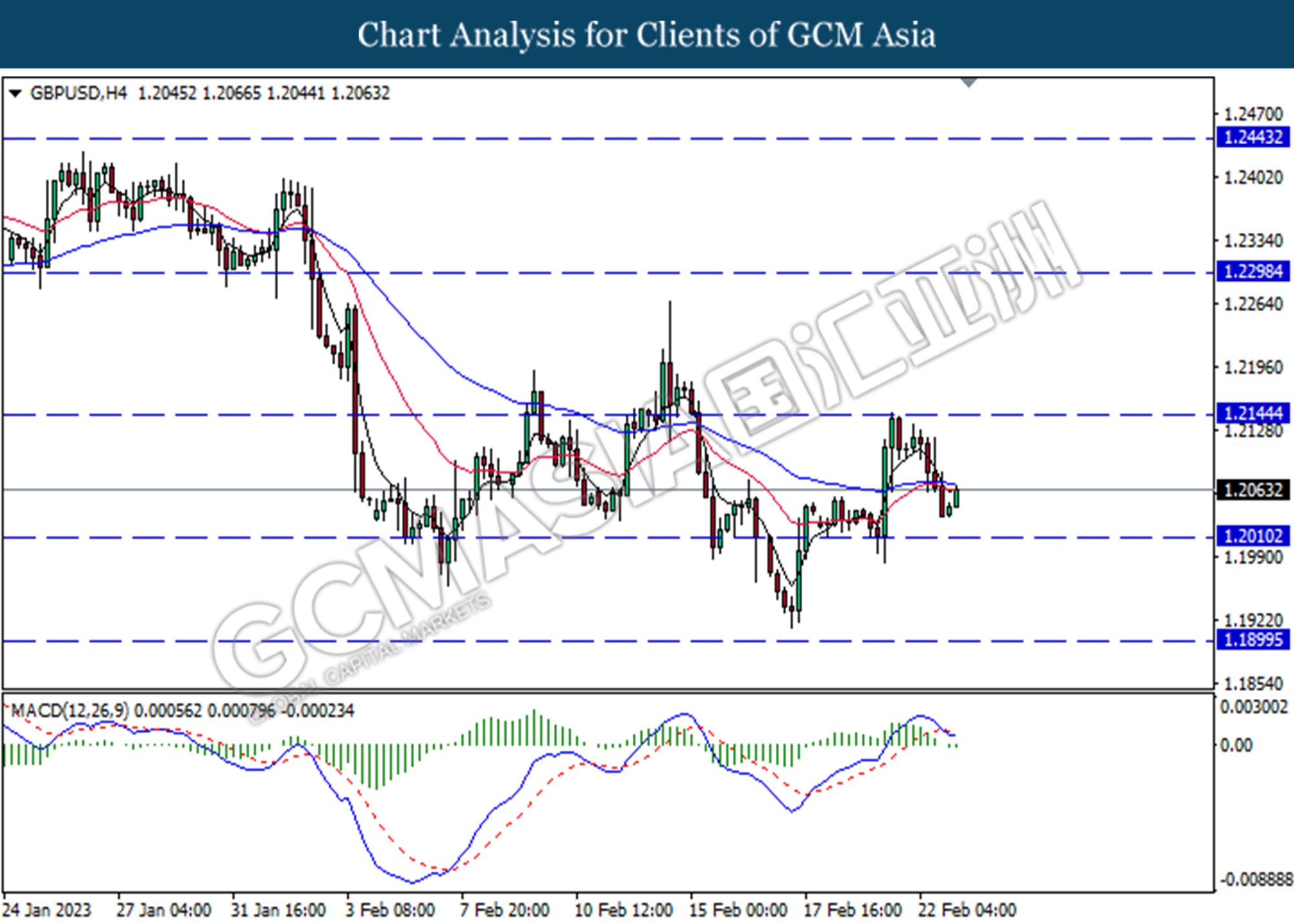

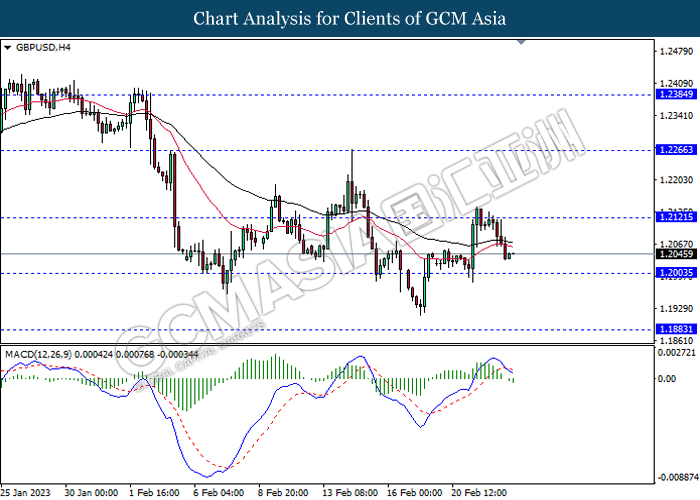

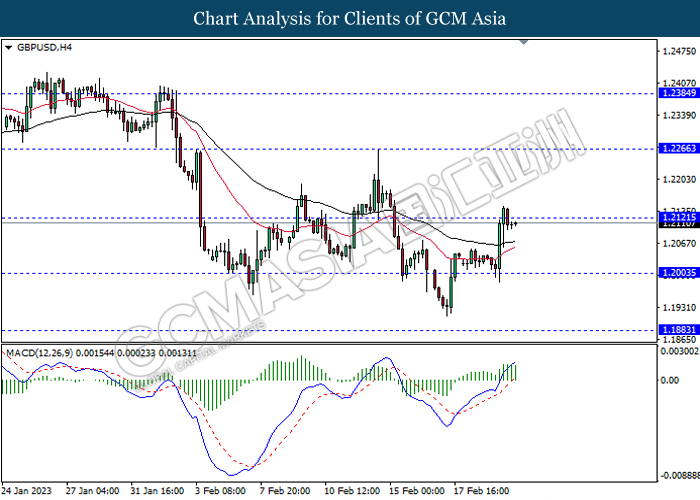

GBPUSD, H4: GBPUSD was traded lower following the prior break below from the previous support level at 1.2010. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2010, 1.2145

Support level: 1.1900, 1.1760

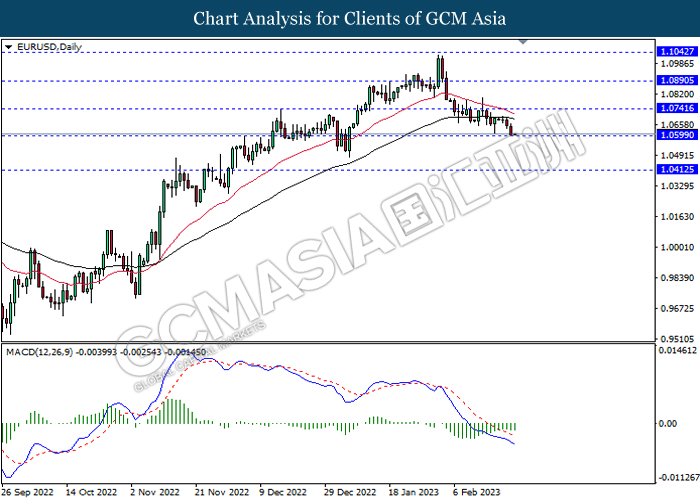

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

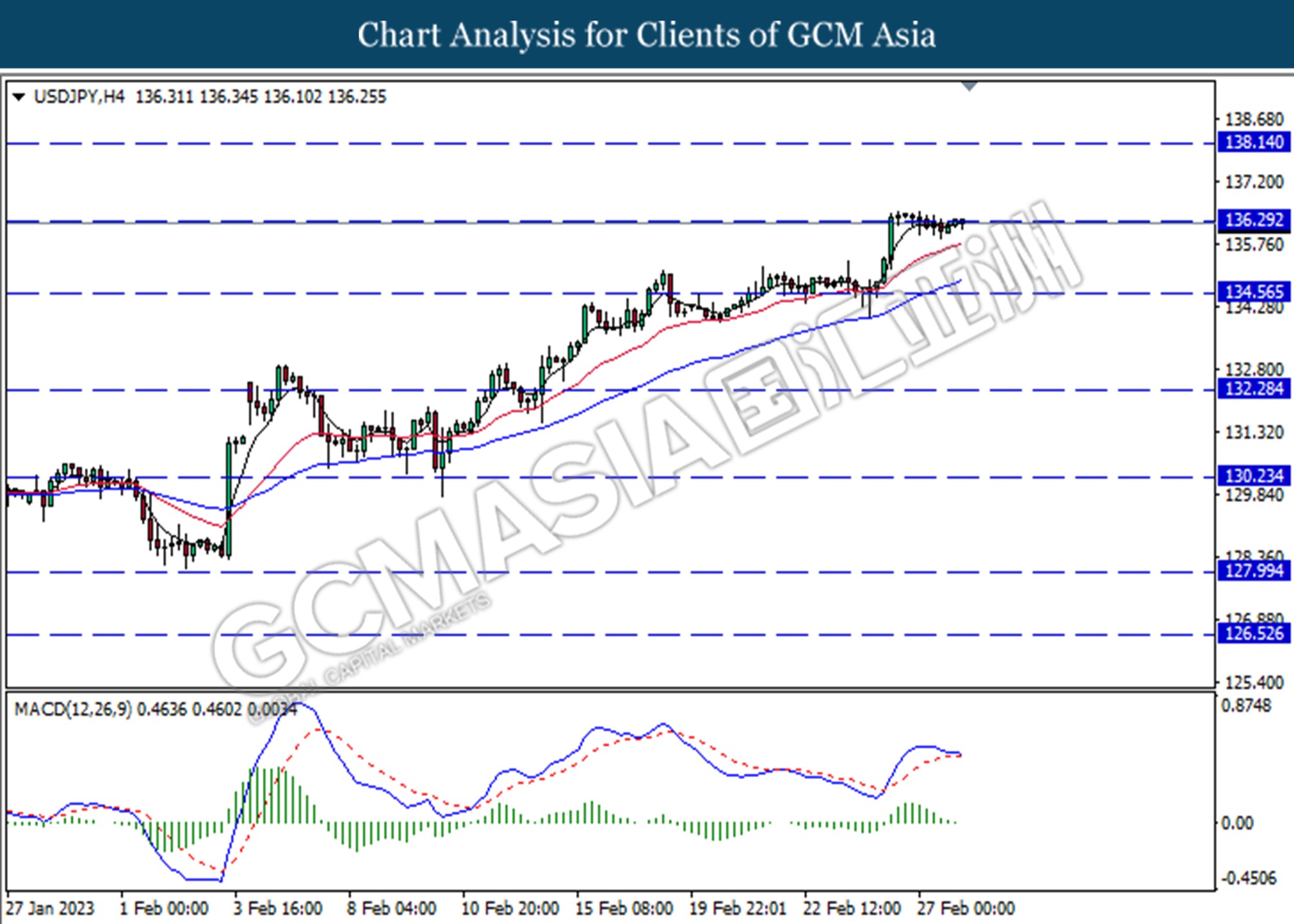

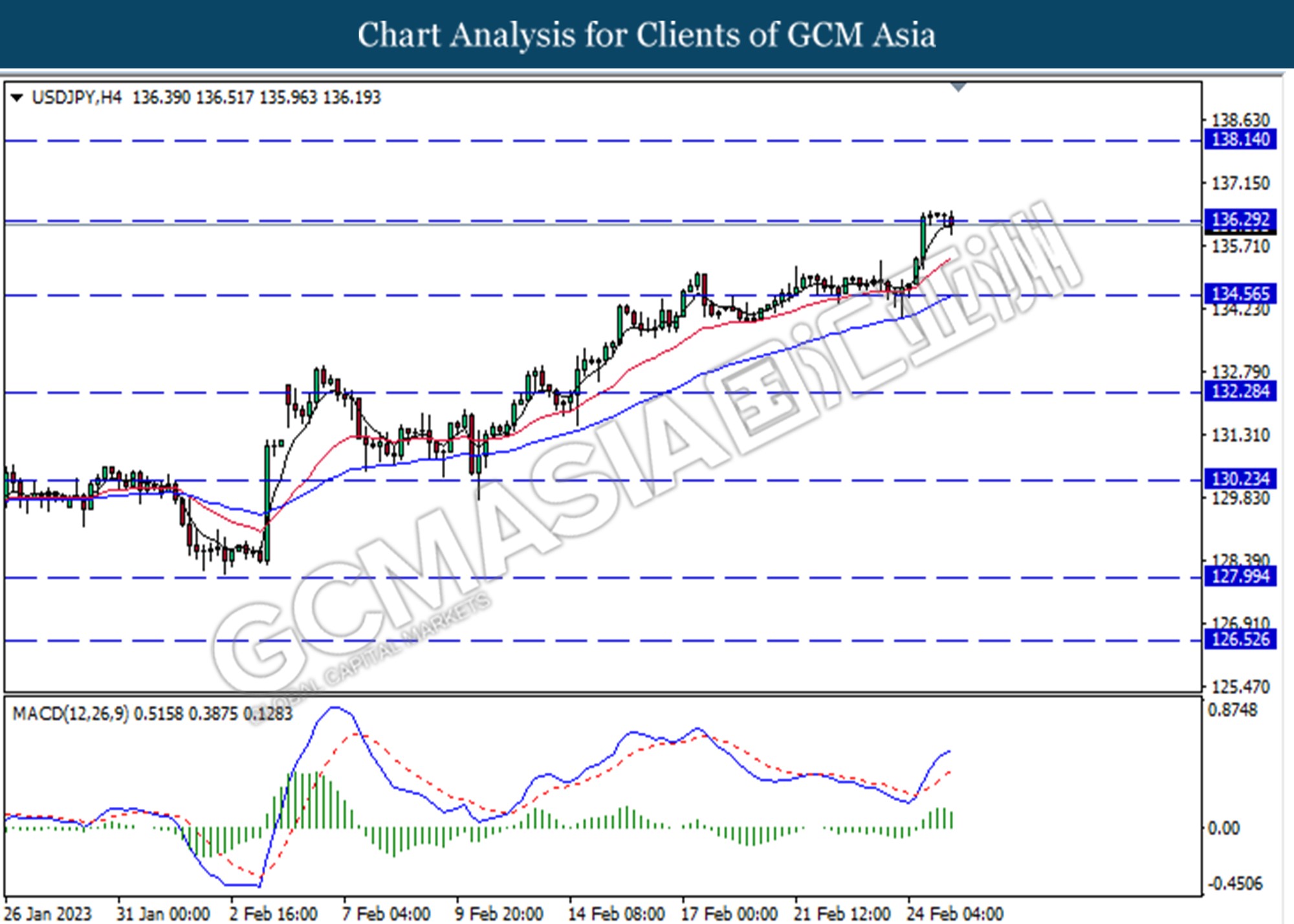

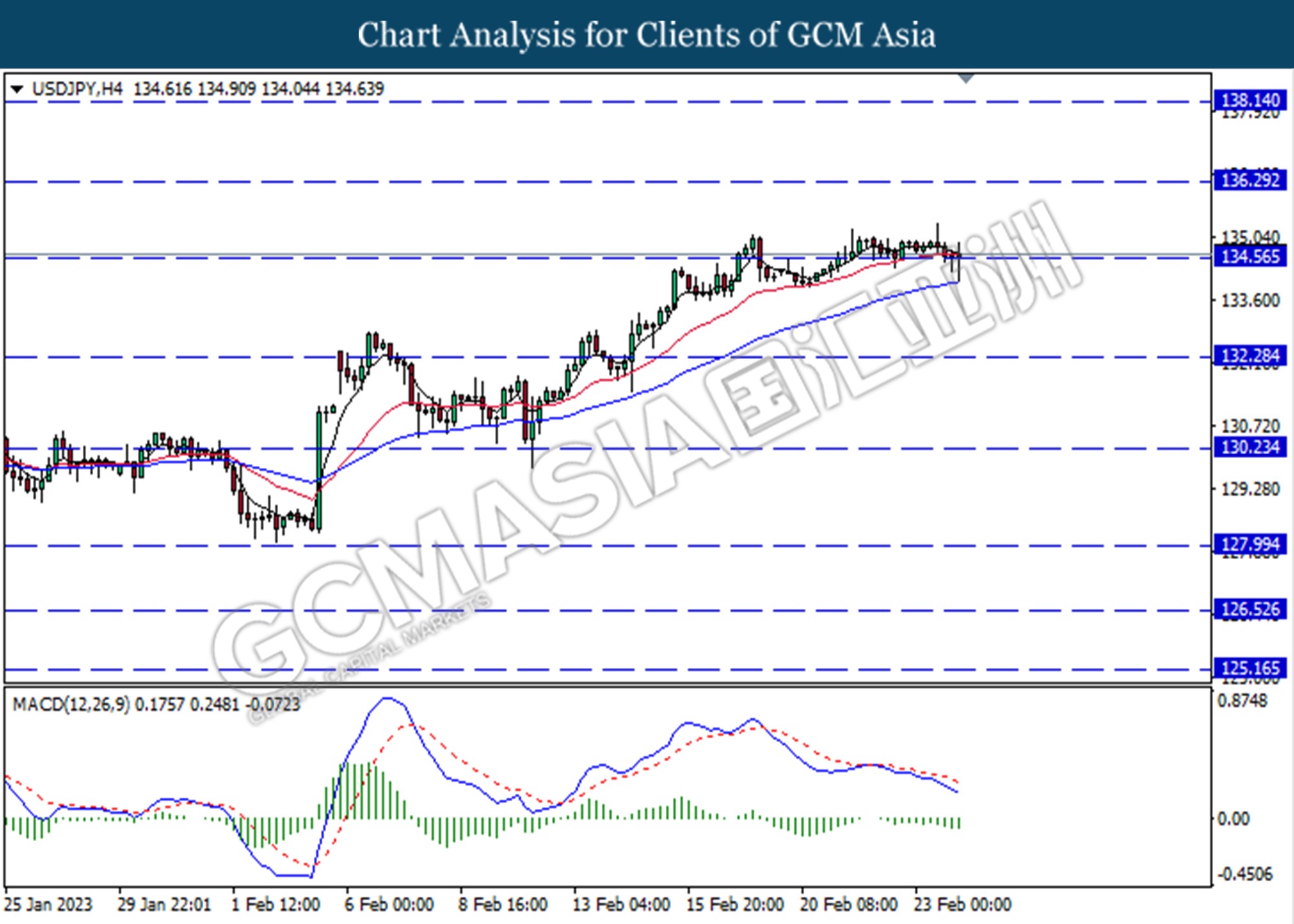

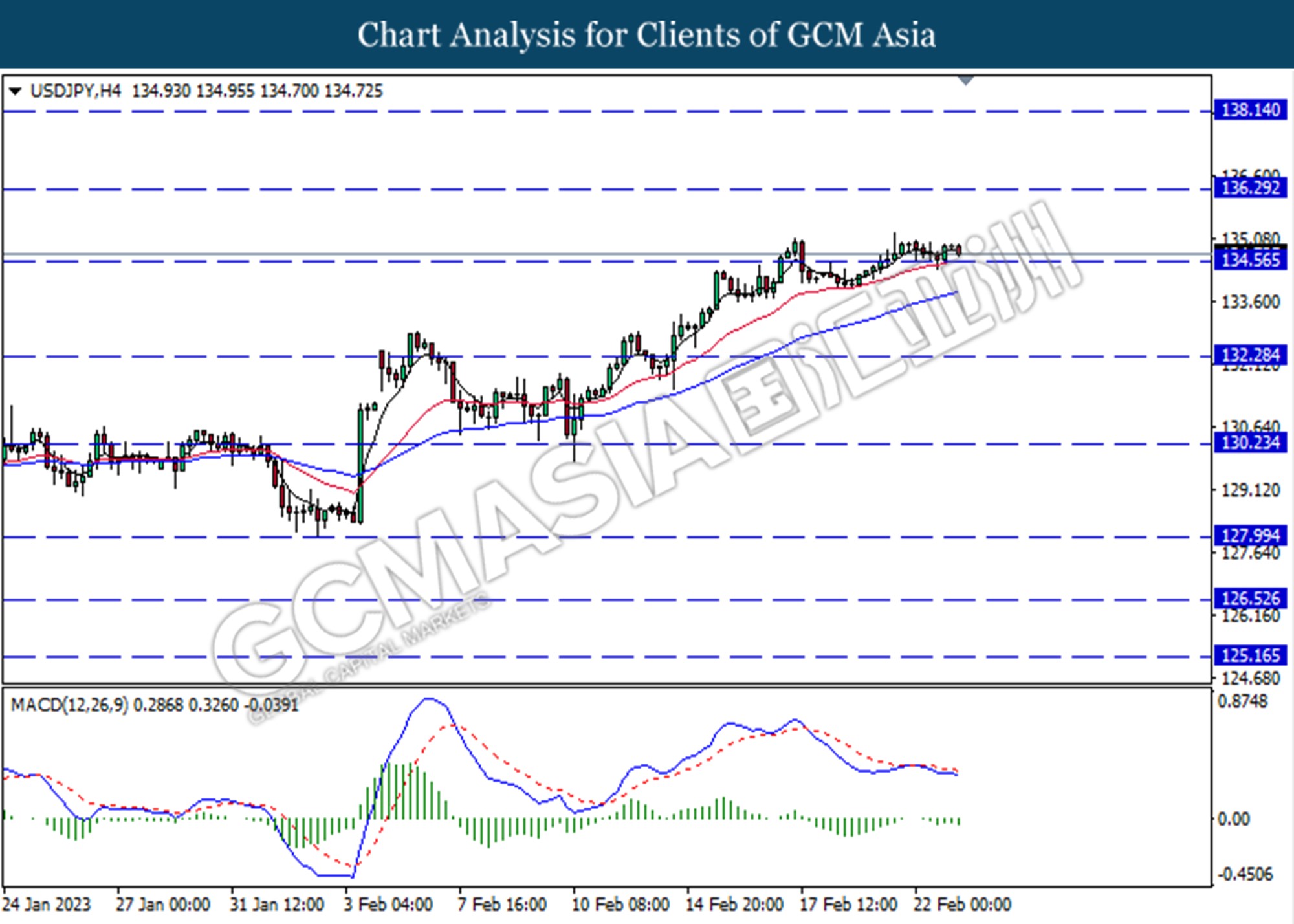

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 136.30. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

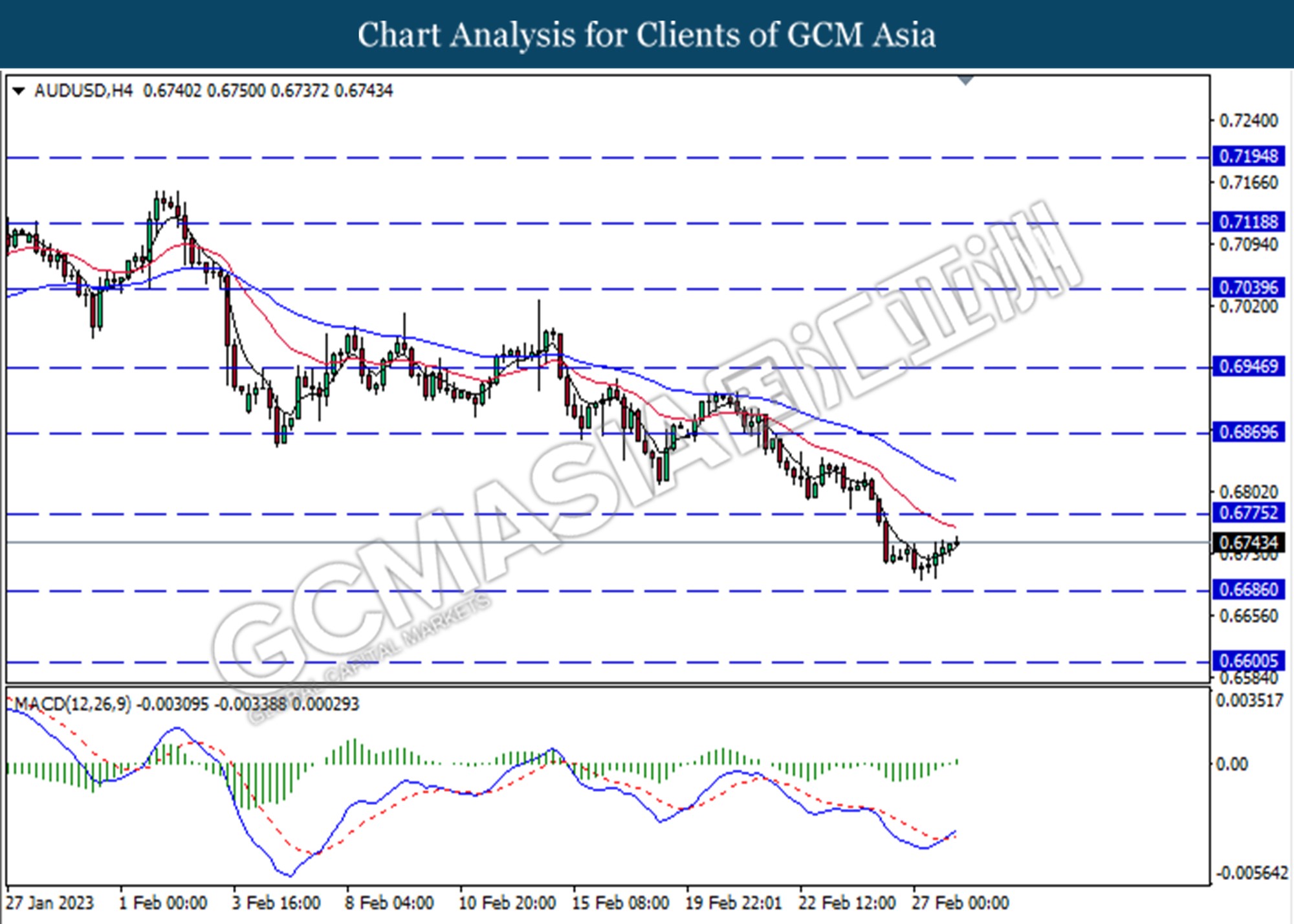

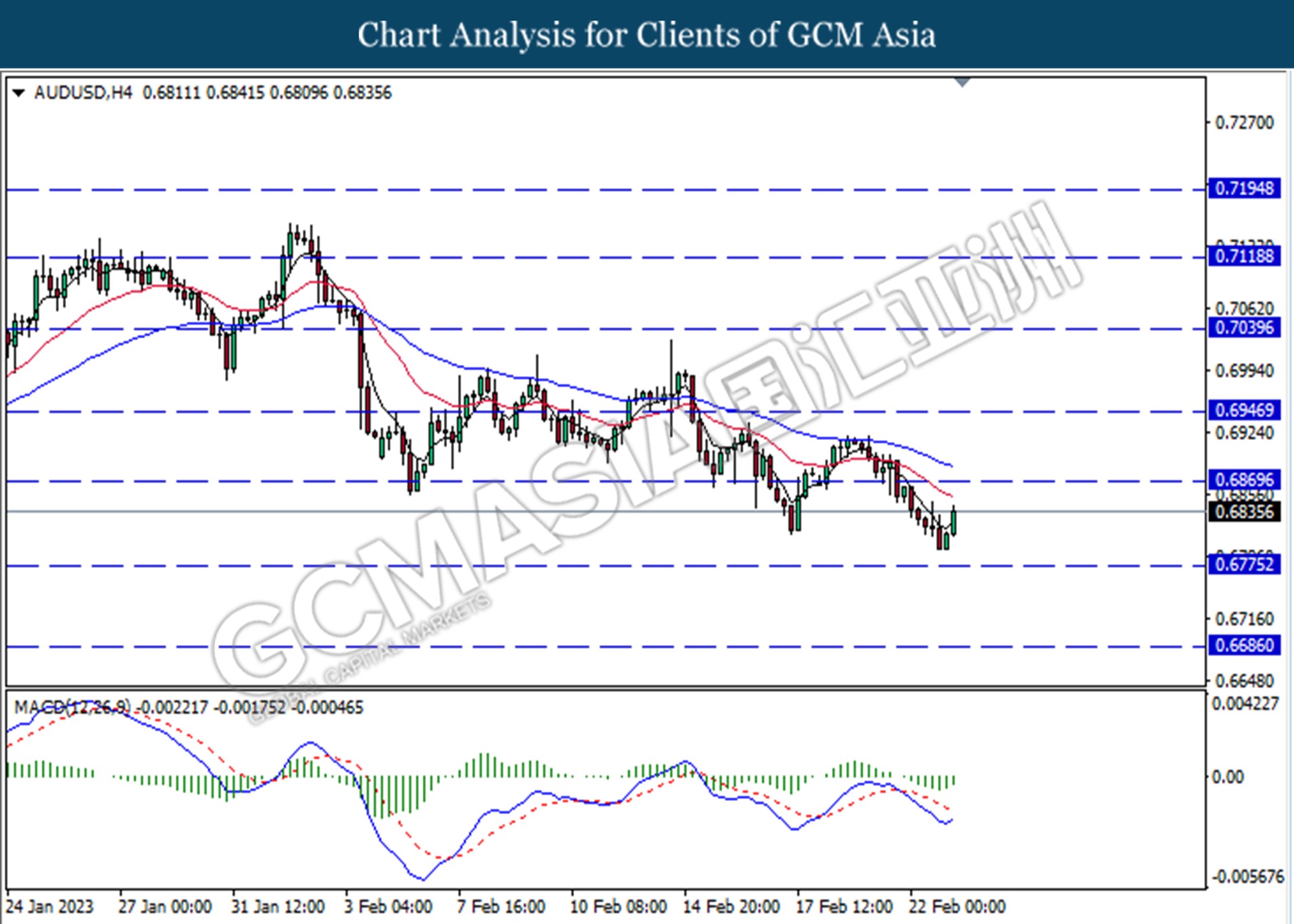

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6685

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

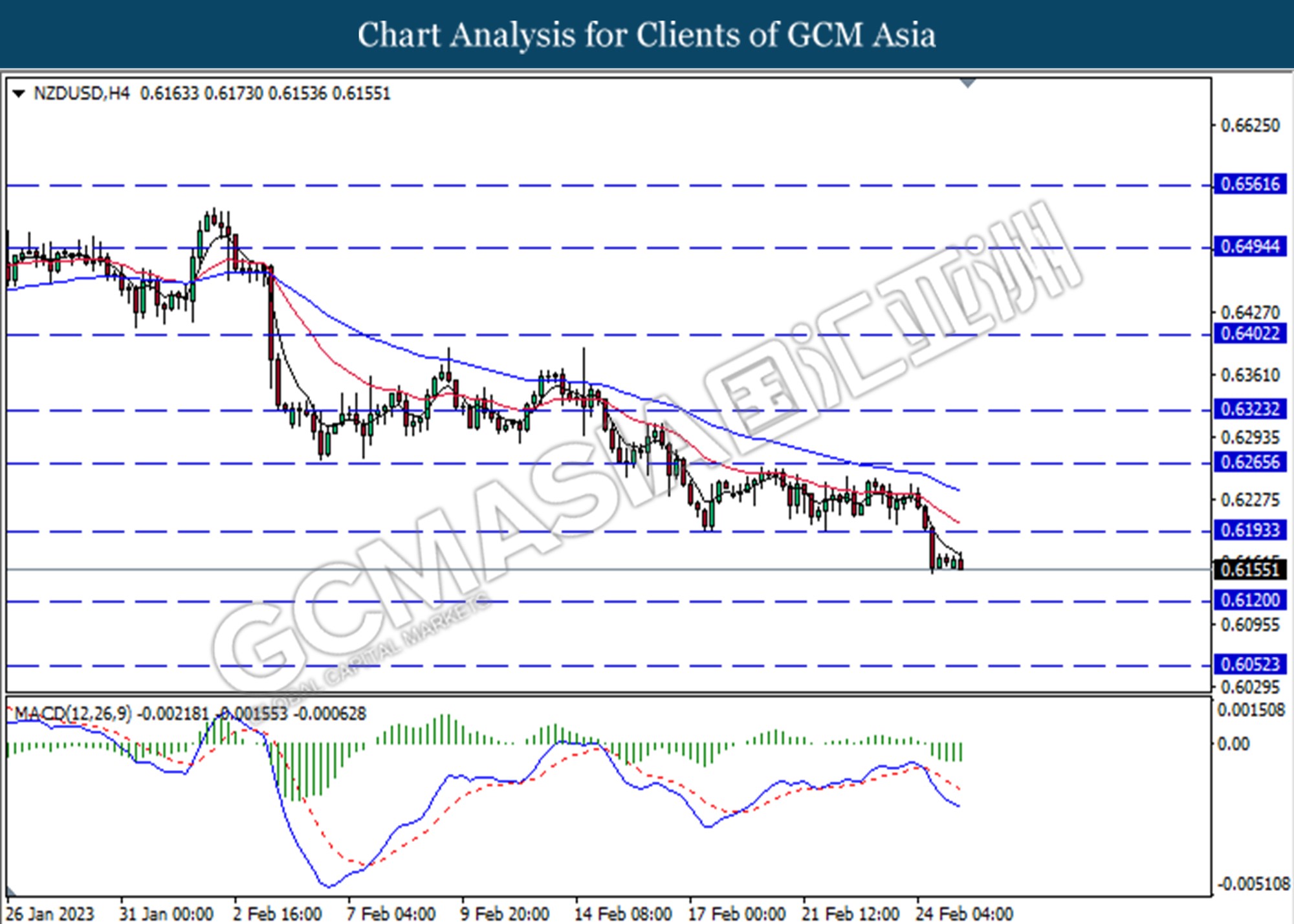

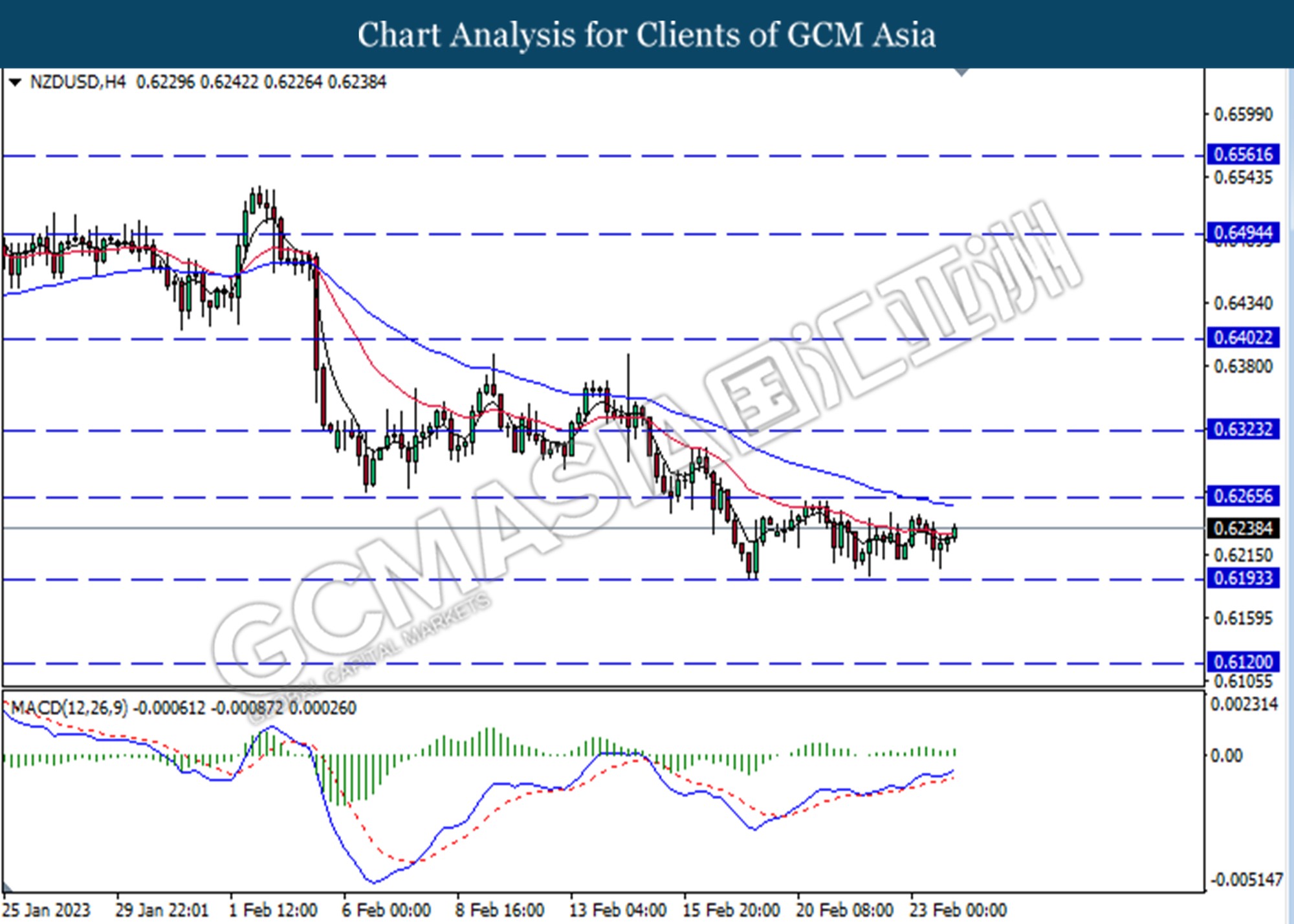

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from the resistance level at 0.6265. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6195.

Resistance level: 0.6265, 0.6325

Support level: 0.0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3685.

Resistance level: 1.3685, 1..3785

Support level: 1.3600, 1.3515

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9380. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.9470.

Resistance level: 0. 9470, 0.9545

Support level: 0.0.9380, 0.9320

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 76.05. MACD which illustrated bullish bias suggests the commodity to extend its gains toward the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

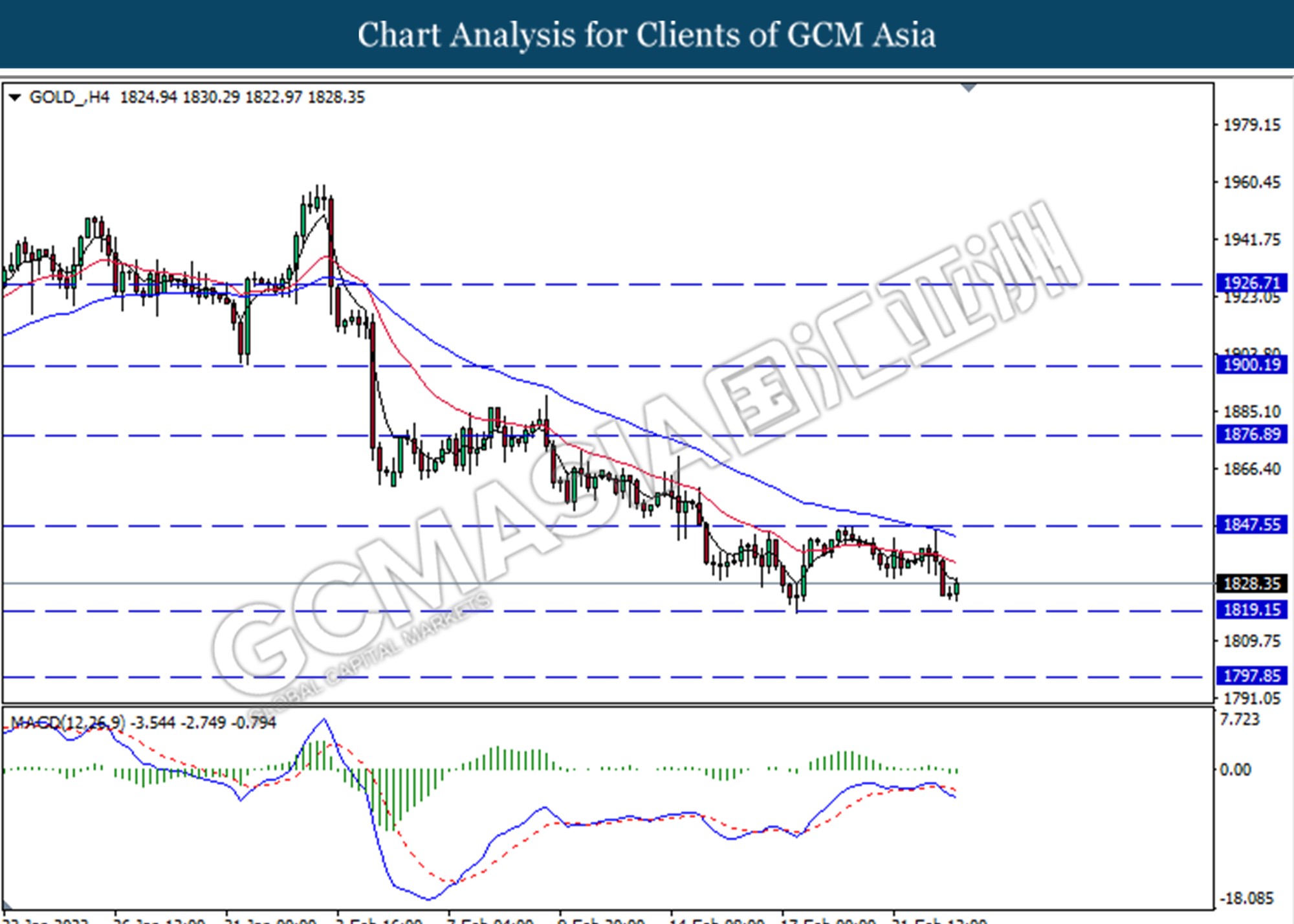

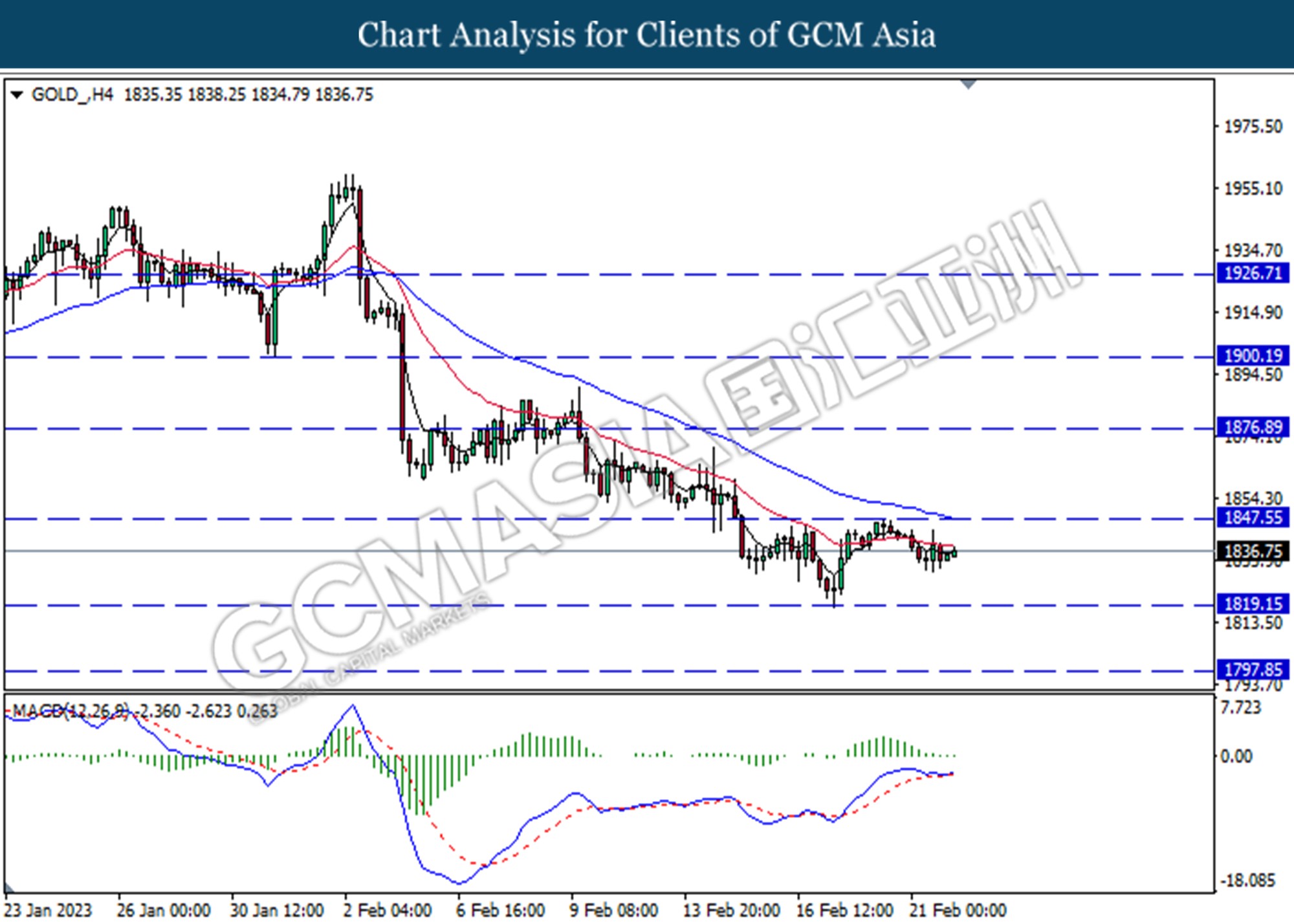

GOLD_, H4: Gold price was traded lower following a prior retracement from the resistance level at 1847.55. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1819.15.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1800.30

020323 Morning Session Analysis

02 March 2023 Morning Session Analysis

Dollar slumped amid optimism over China’s economic recovery.

The dollar index, which is traded against a basket of six major currencies, lost its luster recently as the upbeat economic data in China had boosted the market optimism over the on track recovery in the second largest economy in the world. Yesterday, China posted its Manufacturing PMI data and Non-Manufacturing PMI at 52.6 and 56.3, stronger than the consensus forecast at 50.5 and 55.0 respectively. These data mirrored that the China’s factory and services activity experienced a decent rebound in the month of February after the reopening of economy not too long ago. With that, it wiped off the cloudy outlook of the China economy while sparked large buying momentum in the related currency market, such as the major trading partners of China including Aussie and New Zealand dollar. Besides, the US manufacturing activity contracted for the fourth consecutive straight month in February, yet showing some sign of activity stabilization compared to the previous month. According to the ISM, the US Manufacturing PMI rose from the prior month’s reading of 47.4 to 47.7 in February, slightly below the consensus forecast at 48.0. As of writing, the dollar index dropped 0.44% to 104.40.

In the commodities market, crude oil prices were up by 1.17% to $77.60 per barrel as China recovery hopes outweighed the rising oil inventories level in the US. Besides, gold prices edged up by 0.58% to $1837.15 per troy ounce as the Greenback failed to revive amid disappointed manufacturing activity growth in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Feb) | 8.6% | 8.2% | – |

| 21:30 | USD – Initial Jobless Claims | 192K | 197K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the downward trend line. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0665, 1.0770

Support level: 1.0445, 1.0275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6230. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6230.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 73.25

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1835.00 MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1835.00.

Resistance level: 1835.00, 1859.90

Support level: 1821.60, 1809.15

010323 Afternoon Session Analysis

01 March 2023 Afternoon Session Analysis

AUD slipped after inflation eased in January.

The Australian dollar was facing selling pressure due to mixed economic data that had been released. The AUD/USD pair was lingering below the level of 0.6775 as inflation eased in January and growth in the gross domestic product (GDP) slowed in December. The consumer price index (CPI) was at 7.4%, which is the second-highest annual increase, but it was still lower than the market’s expectations at 8.1% and December’s reading of 8.4%. The decrease in food and fuel prices in January contributed to the lower reading, but this was offset by the appreciation in housing price. An increase in interest rates and rising rents caused the appreciation in mortgage prices. Additionally, the Australian Gross Domestic Product (GDP) grew by 0.5%, lesser than market expectation on a monthly basis, while on an annual basis, it grew by 2.7%, in line with the market expectation. Slow growth in economic conditions reduced the economic headroom for RBA to keep hiking its interest rate. As a result, the pair of AUD/USD declined after the release of the downbeat CPI and GDP data. However, the massive sell-off in the Aussie market was largely offset by the China’s optimistic economic data that was released this morning. According to the China Federations of Logistics, the Manufacturing PMI stood at 52.6, well above the market expectation at 50.5, while the services PMI stood at 56.3, beating the market expectation of 55.0. The AUD was boosted by China positive economic data, reviving the Aussie dollar from the brink of collapse. As of writing, the AUD/USD rose by 0.28% to $0.6745.

In the commodities market, crude oil prices were traded up by 0.55% to $77.47 per barrel as China optimistic economic condition outweighed the rising crude oil inventories in the US. Besides, gold prices appreciated by 0.03% to $1837.25 per troy ounce as the US CB consumer Confidence fell below market expectations.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 46.5 | 46.5 | – |

| 16:55 | EUR – German Unemployment Change | -15K | 9K | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 49.2 | 49.2 | – |

| 21:00 | EUR – German CPI (YoY) (Feb) | 8.7% | 8.7% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 47.4 | 48.0 | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 7.648M | 0.440M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior rebound from the support level at 104.45. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 105.85.

Resistance level: 105.85, 106.95

Support level: 104.45, 103.00

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2145. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2010.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.0635. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

USDJPY, H4: USDJPY was traded higher following a break above the previous resistance level at 136.30. However, MACD which illustrated bearish momentum suggest the pair to undergo technical correction in the short term.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6195. MACD which illustrated increasing in bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3560. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3685.

Resistance level: 1.3685, 1.3785

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9380. MACD which illustrated bullish momentum suggest the pair to extend its gains toward the resistance level at 0.9470.

Resistance level: 0.9470, 0.9550

Support level: 0.9380, 0.9320

CrudeOIL, H4: Crude oil price was traded higher following a rebound from a lower level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 1819.15. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 1847.55.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1800.30

010323 Morning Session Analysis

01 March 2023 Morning Session Analysis

Risk-on sentiment weighed on Greenback.

The dollar index, which is traded against a basket of six major currencies, extended its losses in the previous trading session as the market risk appetite revived after UK and EU sealed the Northern Ireland protocol deal. Earlier of the week, both parties finally struck a decisive breakthrough on a post-Brexit deal to avoid a hard border on the island of Ireland. With such a backdrop, the surge in market risk appetite has infused some strength into the riskier currencies such as Pound and Euro. On top of that, the dollar index dragged down further following the announcement of the CB Consumer Confidence Index. According to the Conference Board, the US Consumer Confidence data declined from the prior month’s reading of 106 to 102.9 in February, missing the consensus forecast at 108.5. However, the losses of the dollar index were limited as the recent strong economic data boosted the market expectation that the Federal Reserve will bring a bigger rate hike plan onto the table in the upcoming meeting. According to the CME FedWatch Tool, the likelihood of a 50 basis point rate hike in the upcoming meeting lies at 26.2%, which increased from the previous week’s reading at 24.0%, while there is a 73.8% of possibility that the Fed will carry out a 25-basis point of a rate hike. As of writing, the dollar index surged 0.26% to 104.95.

In the commodities market, crude oil prices were up by 1.55% to $76.75 per barrel as investors expected a strong economic rebound in China. Besides, gold prices edged up by 0.58% to $1827.90 per troy ounce as the US dollar lost its ground during the early Asian trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 46.5 | 46.5 | – |

| 16:55 | EUR – German Unemployment Change | -15K | 9K | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 49.2 | 49.2 | – |

| 21:00 | EUR – German CPI (YoY) (Feb) | 8.7% | 8.7% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 47.4 | 48.0 | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 7.648M | 0.440M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently retesting the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0445, 1.0275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6160. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher while currently retesting the resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 81.80

Support level: 73.25, 71.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1821.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1821.60.

Resistance level: 1821.60, 1835.00

Support level: 1809.10, 1786.00

280223 Afternoon Session Analysis

28 February 2023 Afternoon Session Analysis

Aussie appreciated after upbeat retails sales data.

The Aussie, as one of the major traded currencies globally, experienced some gains during the Asia market opening amid upbeat economic data announced. The monthly reading of the retail sales data pinned at 1.9%, higher than the market consensus at 1.5%, according to the Australian Bureau of Statistics. The strong data was driven by a recovery in the non-food sector after sharp losses last month, as consumers shifted spending patterns with the backdrop of high inflation. Therefore, retail sales slumped in December as consumers took advantage of November’s Black Friday discounts. Besides, Australia’s inflation remained tight at around 30 years high, and investors forecast a higher inflation figure in the coming months. These factors gave the Reserve Bank of Australia (RBA) more room to hike the interest rates further. However, the gains of the Aussie were limited by the stronger dollar. Investors are expecting more aggressive rate hikes from the Fed after a series of positive US economic data were released. As of writing, the AUD/USD traded down by -0.08% to $0.6728.

In the commodities market, crude oil prices were traded up by 0.24% to $75.92 per barrel as investors awaited the economic data from China. Besides, gold prices were traded down by -0.26% amid heightening investor’s concerns over rising interest rates and anticipation of key US economic readings.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.1% | 0.1% | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 107.1 | 108.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bullish momentum suggests the index to extend its losses toward the support level at 104.45.

Resistance level: 105.85, 106.95

Support level: 103.50,103.00

GBPUSD, H4: GBPUSD was traded higher following the prior break above from the previous resistance level at 1.2010 MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.2145.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 136.30. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 136.30, 138.15

Support level: 134.60, 132.30

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 0.6775

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following a rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower following the prior break below from the previous support level at 1.3600. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following the prior break below the previous support level at 0.9380. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9320.

Resistance level: 0.9380, 0.9470

Support level: 0.9320, 0.9240

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo a technical rebound in short term.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded higher while currently testing for the resistance level at 1819.15. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains if successfully breaks above the resistance level.

Resistance level: 1819.15, 1847.55

Support level: 1800.28, 1777.40

280223 Morning Session Analysis

28 February 2023 Morning Session Analysis

Dollar rally cools as risk appetites improve.

The dollar index, which traded against a basket of six major currencies, gave up some gains after hitting its highest level since the beginning of Jan 2022 as the market risk appetite recovered. Yesterday, the dollar index lost its ground after UK Prime Minister Rishi Sunak has finally come into a consensus with EU on some pending issue around Northern Ireland. A deal has been signed by the supreme leaders from the both nation after a decisive breakthrough since Brexit. In short, the deal is included with the framework of safeguarding trade flows within the UK, protecting Northern Ireland’s place within the UK and so on. Despite, the exact details about the deal is not available at the moment, but it is promised to be announced sooner or later. With the deal has been sealed, it boosted the positive sentiment in both the Euro and Pound market amid brighter economic prospect. On top of that, the market participants looked past the yesterday’s economic data while paying their attentions over the upcoming ISM data. As of writing, the dollar index dropped by -0.54% to 104.65.

In the commodities market, crude oil prices slid by -0.94% to $75.60 per barrel as recent strong economic data increased the likelihood of aggressive rate hike in the future, which dampened the outlook of oil demand. Besides, gold prices rose by 0.31% to $1817.30 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.1% | 0.1% | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 107.1 | 108.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the lower. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0665.

Resistance level: 1.0665, 1.0770

Support level: 1.0445, 1.0275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6160. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9310.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 81.80, 86.15

Support level: 76.10, 73.25

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1809.10. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1821.60.

Resistance level: 1821.60, 1835.00

Support level: 1786.00, 1725.35

270223 Afternoon Session Analysis

27 February 2023 Afternoon Session Analysis

Euro losses were limited by Lagarde’s hawkish speech.

The euro, as one of the most traded currencies by the global investor, closed lower last Friday as the US core PCE index surged, strengthening the dollar and sparked sell-off pressures on the pairing of EUR/USD. However, the losses of the euro currency were limited by the European Commission, President Christine Lagarde’s speech. In the interview, Lagarde reiterated that inflation in the eurozone was still high and the recent drop in inflation was mainly attributed to the decline in energy prices. According to Eurostat, the January inflation rate reduced slightly by 0.6% to 8.6% but the core inflation in the eurozone stood at 5.3%, higher than the prior reading of 5.2%. These data give more room for ECB to aggressively hike rates since it inflation target is 2%. The comments prompted investors that ECB will continue to hike rates for another 50-basis point and strengthen the position of the Euro. In addition, Eurozone will release Its CPI data in later this week, where the investors are waiting for more cues from the release of the data. As of writing, the EUR/USD slipped -0.08% to $1.0537.

In the commodities market, crude oil prices edged down by -0.71% to $75.81 per barrel amid a stronger dollar and market concern over the recession risks. Besides, gold prices depreciated by -0.09% to $1815.50 per troy ounce amid the increased expectation of an aggressive rate hike by the Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | -0.2% | 0.1% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | 2.5% | 1.0% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 104.45.

Resistance level: 106.95, 105.85

Support level: 104.45, 103.00

GBPUSD, H4: GBPUSD was traded lower following a prior break below the previous support at 1.2010. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 1.1900

Resistance level: 1.2010, 1.2145

Support level: 1.1900, 1.1760

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.0635, 1.0790

Support level: 1.0505,1.0360

USDJPY, H4: USDJPY was traded lower following a break below the previous support level at 136.30. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 134.55.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded lower following a prior break below the previous support level at 0.6775. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower currently testing for the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9380. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9470

Resistance level: 0.9470, 0.9545

Support level: 0.9380, 0.9320

CrudeOIL, H4: Crude oil price was traded lower currently testing for the support level at 76.05. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after successfully breaking below the support level.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded lower following the prior breakout below the previous support level at 1819.15. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1800.30

Resistance level: 1819.15, 1876.90

Support level: 1800.30, 1777.40

270223 Morning Session Analysis

27 February 2023 Morning Session Analysis

Greenback skyrocketed as inflation resurged.

The dollar index, which traded against a basket of six major currencies, managed to extend its rallies as the Fed’s preferred inflation gauge accelerated in January. According to the Bureau of Economic Analysis, the US Core PCE Price Index surged unexpectedly from the prior month’s reading of 0.4% to 0.6% last month, adding further pressure on the policymakers to curb inflation. Prior to that, the inflation figure has started to ease over the past few months, thanks to the aggressive rate hike plan by the Federal Reserve since early last year. However, with the backdrop of stubbornly high inflation, it may reinforce the Federal Reserve to continue with its rate hike plan, leaving the rate at a high level for longer or greater rate adjustment. All in all, a series of upbeat data has flipped the table over in the dollar market, saving the Greenback from the brink of collapse. On top of that, the dollar index shined as the instability of geopolitical issues in Iran boosted the market demand against the safe haven currency. Among them, the disputed nuclear program, human rights violations, and the supply of drones to Russia are the major factors that urged the investors to exit the country’s financial market amid the prospect of economic hardship. As of writing, the dollar index rose 0.63% to 105.25.

In the commodities market, crude oil prices rose by 1.09% to $76.30 per barrel as Russia halted oil supplies to Poland, said by Polish refiners. Besides, gold prices slumped by -0.59% to $1811.60 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | -0.2% | 0.1% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | 2.5% | 1.0% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 105.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1940. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0445.

Resistance level: 1.0575, 1.0665

Support level: 1.0445, 1.0275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6160. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the next resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 73.25

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1821.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1786.00

Resistance level: 1821.60, 1835.00

Support level: 1786.00, 1725.35

240223 Afternoon Session Analysis

24 February 2023 Afternoon Session Analysis

Eurodollar slipped as Eurozone Inflation cooled down.

The Euro, as one of the most traded currencies by the global investor, slipped after the Eurostat CPI report was released. The annual inflation was down to 8.6% in January compared to December at 9.2%, mainly due to falls in the prices of food, alcohol, and tobacco. Moreover, the increase in the US dollar has further declined the euro dollar. According to the Department of Labor, the Initial Jobless Claims were reduced by 3k to 192k, lower than the market expectation of 200k. This indicated that the US has a strong labor market, which created more room for Fed’s further rate hikes. Therefore, the US dollar strengthened and weakened the value of the Euro. However, the losses of the Euro were offset by the European Central Bank’s (ECB) tightening monetary stance. In order to tame the sky-high inflation in Eurozone, ECB has started to increase its interest rate aggressively since the mid of 2022. ECB Chairman Christine Lagarde reiterated that the central bank wishes to raise its interest rate by 50 basis points in March. The inflation has generally declined but the core CPI increased by 0.1% to 5.3%, higher than the previous reading of 5.2%. With that, it does not rule out the possibility ECB will hike rates aggressively in the future. As of writing, the EUR/USD was traded higher by 0.06% to $1.0601.

In the commodities market, crude oil prices edged up by 0.98% to $76.12 per barrel as Russia’s supply cuts tempered market concerns over rate hikes. Besides, gold prices appreciated by 0.29% to $1822.60 per troy ounce amid an unclear signal from the Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core PCE Price Index (MoM) (Jan) | 0.3% | 0.4% | – |

| 23:00 | USD – New Home Sales (Jan) | 616K | 620K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 104.45. However, MACD which illustrated bearish momentum suggests the index to undergo technical correction in a short term

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2010. MACD which illustrated bearish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded lower following a prior retracement from the previous support level at 1.0635. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.0635.

Resistance level: 1.0635, 1.0790

Support level: 1.0575, 1.0445

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 134.55. MACD which illustrated bearish momentum suggests the pair to extend its losses after it successfully breakout above the support level.

Resistance level: 136.30. 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded higher following a rebound from the lower level. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6870.

Resistance level: 0.6870, 0. 6945

Support level: 0.6775, 0.6685

NZDUSD, H4: NZDUSD was traded higher following a rebound from the lower level. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3690

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded higher following a prior break out above the previous resistance level at 0.9320. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9380.

Resistance level: 0.9380, 0.9470

Support level: 0.9320, 0.9240

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the upward trend line while currently testing for the resistance level at 76.05. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains if successfully breaks above the resistance level.

Resistance level: 76.05, 78.70

Support level: 73.20,70,65

GOLD_, H4: Gold price was traded lower following the prior rebound from the support level at 1819.15. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1797.85

240223 Morning Session Analysis

24 February 2023 Morning Session Analysis

US dollar muted amid mixed economic data.

The dollar index, which is traded against a basket of six major currencies, failed to extend its rally yet hovered near the highest level since the beginning of January following the release of mixed data. According to the Bureau of Economic Analysis, the US 4th quarter GDP dropped sharply from the prior reading at 3.2% to 2.7% missing the consensus forecast at 2.9%, reflecting that the Federal Reserve’s rate hike plan dragged down the consumer spending in the United States. The sharp decline in the GDP data has surprised the market participants negatively, as most of the US economic data in recent weeks were so strong and decent. As the GDP is one of the most significant measure of economic growth, the disappointing result has raised the market concern over the desire of Fed further rate hike. Despite, the losses of the greenback were limited, as the US labor market continued to show that it is still remain resilient recently. According to the Department of Labor, the number of Americans filing for unemployment claims declined further from 195K to 192K over the past one week, beating the consensus forecast at 200K. As of writing, the dollar index rose 0.02% to 104.60.

In the commodities market, crude oil prices were up by 2.17% to $75.30 per barrel as the Russia’s oil cut plan and the reopening of China economy outweighed the sharp increase in the US oil inventory. Besides, gold prices edged down by -0.02% to $1822.60 per troy ounce as the US dollar’s strength appears unabated.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q4) | -0.2% | -0.2% | – |

| 21:30 | USD – Core PCE Price Index (MoM) (Jan) | 0.3% | 0.4% | – |

| 23:00 | USD – New Home Sales (Jan) | 616K | 620K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.45

Support level: 133.20, 130.70

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6230. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6230, 0.6160

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3505. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the next resistance level at 1.3600.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 76.10.

Resistance level: 76.10, 81.80

Support level: 73.25, 71.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1835.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1786.00.

Resistance level: 1835.00, 1859.90

Support level: 1786.00, 1725.35

230223 Afternoon Session Analysis

23 February 2023 Afternoon Session Analysis

NZD rose amid RBNZ aggressive rate hike.

The kiwi dollar, as a highly traded currency by the global investor, rebounded after the Reserve Bank of New Zealand’s aggressive rate hike by 50 basis points to 4.75%. According to the RBNZ’s monetary policy statement, the country’s annual inflation stood at 7.2% and is still far away from the central bank target rate of 2%. The board mentioned that the CPI inflation was slightly lower than expected in December 2022, but a higher interest rate is needed to ensure the inflationary pressure eases further. In addition, severe storms across the North islands have disrupted a variety of industries and infrastructures, causing the issue of supply shortages and upward price pressure, and inflation is likely to stay high as a result. Moreover, the 3.4% unemployment rate for the last quarter indicated that the country has a strong labor market while experiencing accelerating growth in household incomes. With that, it will lead to higher household consumption, which will likely cause inflation in New Zealand to remain at a high level for an extended period of time. However, the rebound of the Kiwi was slightly offset by the hawkish statement announced by the Fed. According to the FOMC meeting minutes, Fed officials signaled further tightening of monetary policy. As of writing, the NZD/USD rose 0.47% to $0.6246.

In the commodity market, the crude oil price rose by 0.51% to $74.33 per barrel amid the potential for a deeper oil supply cut by Russia, which amounted to 500k barrels per day. In addition, the gold price depreciated by -0.22% to $1837.40 per troy ounce as of writing amid pressure from the dollar’s strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 8.5% | 8.6% | – |

| 21:30 | USD – GDP (QoQ) (Q4) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 194K | 200K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the resistance level at 104.45. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher following a rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.0635

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

USDJPY, H4: USDJPY was traded higher following a rebound from the support level. However, MACD which illustrated increasing bearish momentum suggests the pair to be traded lower as technical correction.

Resistance level: 136.30, 138.15

Support level: 130.25, 134.55

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains towards the resistance level at 0.6870.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6685

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3515. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses if it successfully breaks below the support level.

Resistance level: 1.3560, 1.3685

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following a prior retracement from the resistance level at 0.9320. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.9240.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains toward the resistance level at 76.05

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the commodity to trade lower as a technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45

230223 Morning Session Analysis

23 February 2023 Morning Session Analysis

US Dollar spiked after FOMC meeting minutes released.

The Dollar Index which traded against a basket of six major currencies rose significantly on Thursday following the Fed officials signaled further monetary policy tightening. Earlier of the day, Fed has unleashed its meeting minutes from the Fed’s Jan 31 to Feb 1 meeting. Fed approved a-quarter-of-percentage rate hike during the last meeting, whereby bringing its interest rate to 4.5% – 4.75%, due to the Federal Reserve Chairman Jerome Powell acknowledged that the inflationary risk was easing. However, some of the members were sticking to their guns as well as suggesting the central bank to hike further rates, and the reason drive them to do this is the inflation rate still well above the Fed’s 2% target. With that, the threat of inflation still remained. Since that meeting, Presidents James Bullard of St. Louis and Loretta Mester of Cleveland have said they were among the group that wanted the more aggressive move. On the other hand, the essential inflationary data, such as CPI and PPI were higher than market expectations, which adding the likelihood of aggressive rate hike implementation by Fed. As of writing, the Dollar Index raised by 0.34% to 104.46.

In the commodity market, the crude oil price rose by 0.12% to $73.94 per barrel as of writing after a sharp decline throughout the overnight trading session over the fresh fears against aggressive rate hike. In addition, the gold price depreciated by 0.03% to $1824.86 per troy ounce as of writing amid the appreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 8.5% | 8.6% | – |

| 21:30 | USD – GDP (QoQ) (Q4) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 194K | 200K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6655

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be trade higher as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1833.55, 1860.10

Support level: 1811.45, 1783.45

220223 Afternoon Session Analysis

22 February 2023 Afternoon Session Analysis

Sterling bulls spring to life after upbeat economic data released.

The GBP, one of the major currencies traded globally, has experienced a massive gain in recent trading sessions amid upbeat economic data announced. According to the data from Markit Economic, UK manufacturing PMI data grew by 2.2 points to the level of 49.2, while services PMI grew by 4.1 points to the level of 53.3. The overall Composite PMI stood at 53.0, which topped the market expectation at 49.0. The data results indicated that the UK economy has gotten rid from contraction as it reduced investors’ worries over the recession of the UK economy. With that, it increased investors’ expectations for a 25-basis point rate hike at the Bank of England’s (BOE) next meeting. Moreover, the UK unemployment rate for the last quarter hit the lowest level since 1974 at 3.5% providing BOE more room for rate hikes in the next monetary policy. As a result, investors increased bets on further BoE rate hikes after the optimistic economic data was released. As of writing, the GBP/USD rose by 0.07% to $1.2123.

In the commodity market, the crude oil price edged up by 0.07% to $76.25 per barrel after a sharp drop in the prior session as the market awaited more cues from FED minutes. In addition, the gold price rose by 0.03% to $1835.09 per troy ounce as the investors sought safe-haven assets amid inflation concerns.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 90.2 | 91.4 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index to extend its losses toward the support level。

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lowest level. MACD which illustrated increasing bullish momentum suggests the pair to be extend its gains toward the resistance level at 1.2145

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher following a prior rebound from the support level at 1.0635. However, MACD which illustrated bearish momentum suggests the pair to be traded lower as a technical correction.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0470

USDJPY, H4: USDJPY was traded higher following a prior break above the previous resistance level at 134.55. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains to the resistance level at 136.30

Resistance level: 136.30, 138.15

Support level: 130.25, 134.55

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6870. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6685

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the support level at 0.6195. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3515. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3560.

Resistance level: 1.3560, 1.3685

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following a prior retracement from a higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

CrudeOIL, H4: Crude oil price was traded higher following a rebound from the support level at 76.05. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following a rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45

220223 Morning Session Analysis

22 February 2023 Morning Session Analysis

US Dollar rallied, buoyed by positive economic data.

The Dollar Index which traded against a basket of six major currencies recorded some earnings on yesterday following the upbeat economic data has been unleashed. According to Markit, the US Services Purchasing Managers Index (PMI) notched up from the previous reading of 46.8 to 50.5, exceeding the consensus forecast of 47.2. Besides, the US S&P Global Composite Purchasing Managers Index (PMI) had raised for the second time in a row. Both data was showing a figures that above 50, indicating the expansion in the US economy sector. Prior to that, robust economic data on retail sales and employment has been released, suggesting a strong start of the US economy at the beginning of the year. With that, the US central bank would likely to keep increasing interest rate to tame inflation. However, the gains experienced by US Dollar was limited after the Russia President delivered a warning to the Western countries. According to Reuters, Russia President Vladimir Putin claimed on Tuesday that the country was suspending a landmark nuclear arms control treaty, and the new strategic systems had been put on combat duty. As of writing, the Dollar Index appreciated by 0.32% to 104.11.

In the commodity market, the crude oil price edged up by 0.07% to $76.25 per barrel as of writing. Though, the oil price slumped on yesterday over the rising fears about aggressive rate hike from Fed, which might threatening global economy. In addition, the gold price rose by 0.03% to $1835.09 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10:00 NZD RBNZ Rate Statement

10:00 NZD RBNZ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German CPI (YoY) (Feb) | 8.7% | 8.7% | – |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 90.2 | 91.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6655

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45