210223 Afternoon Session Analysis

21 February 2023 Afternoon Session Analysis

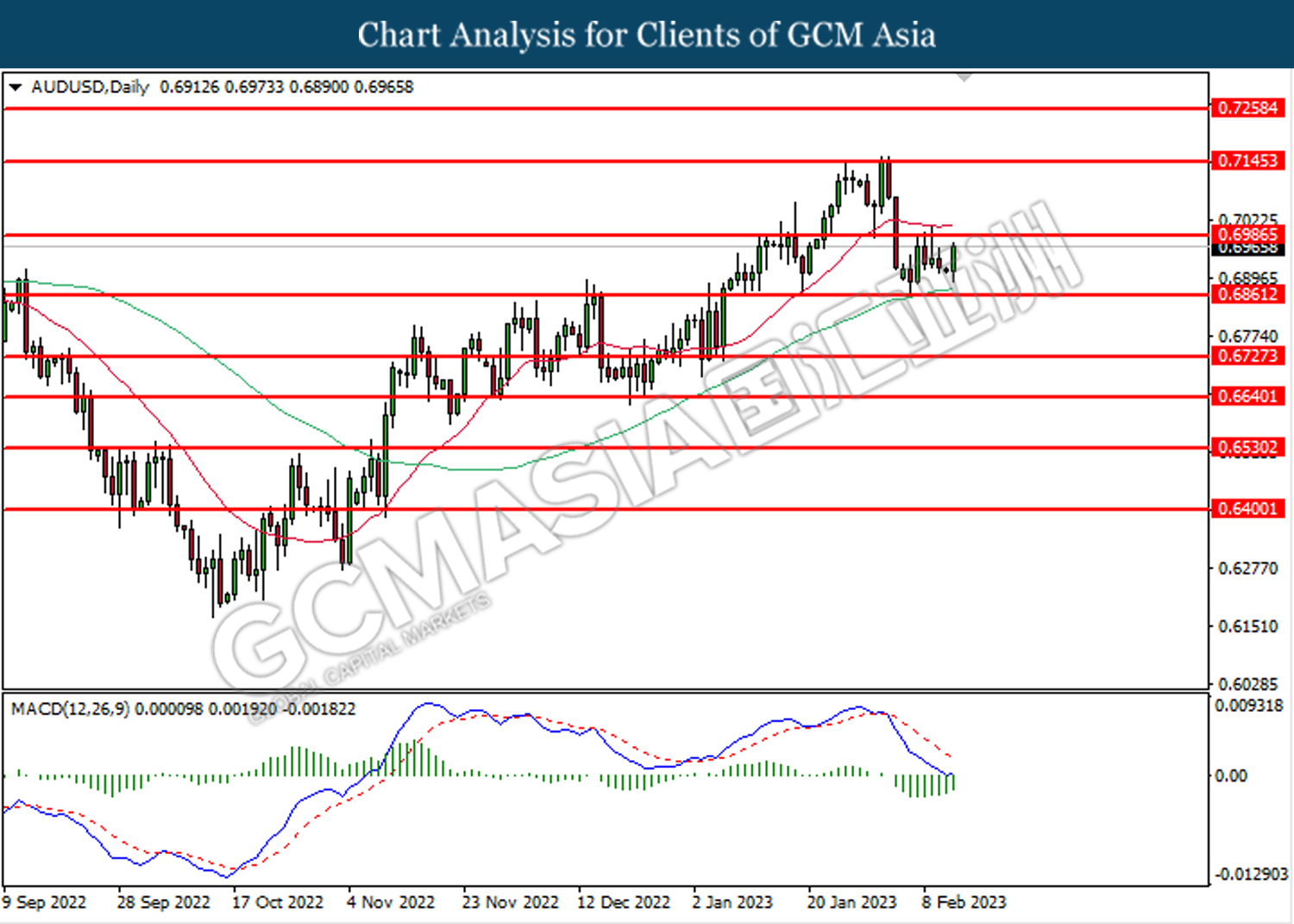

The Aussie uptrend reversed as RBA loosen its monetary decision.

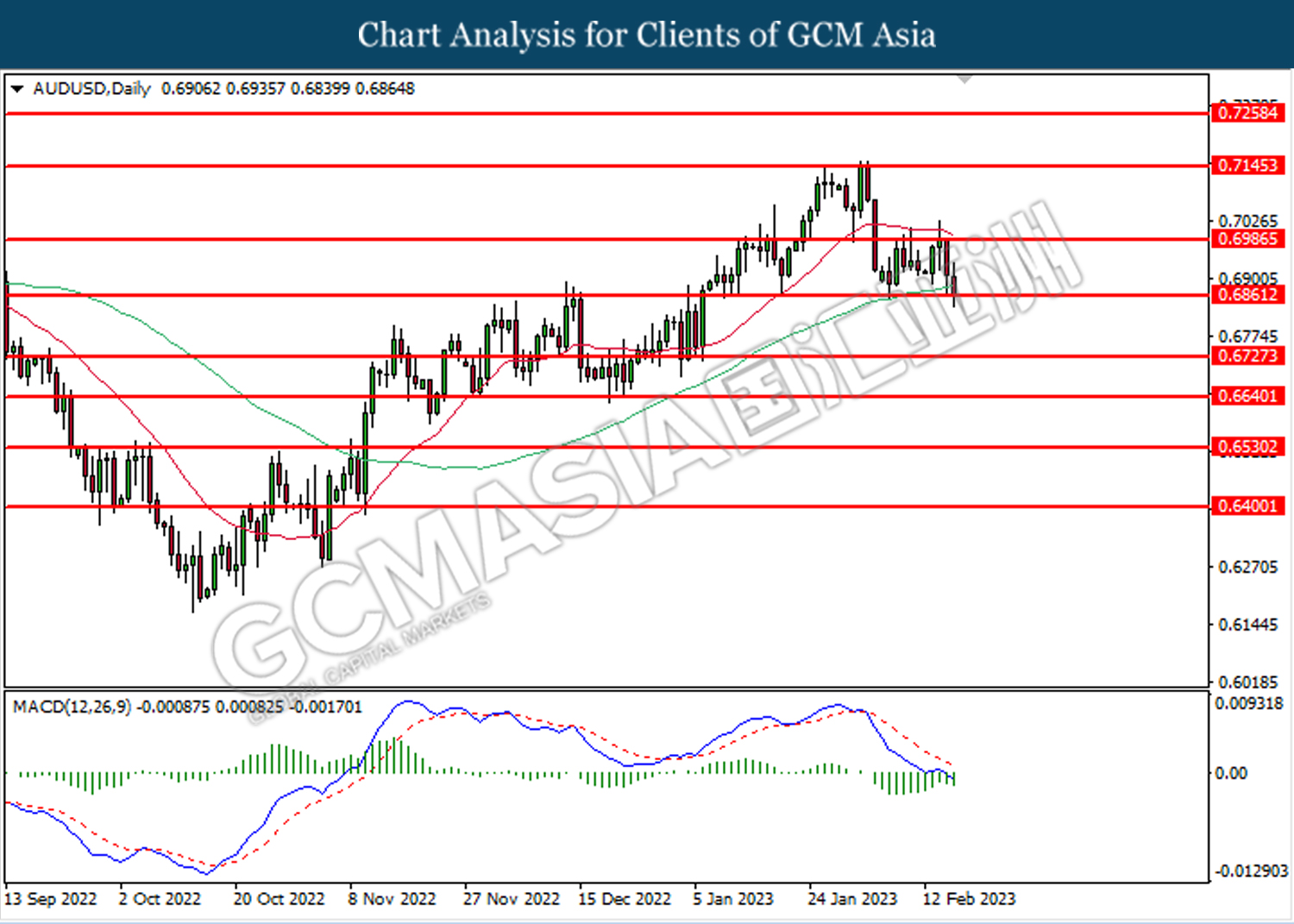

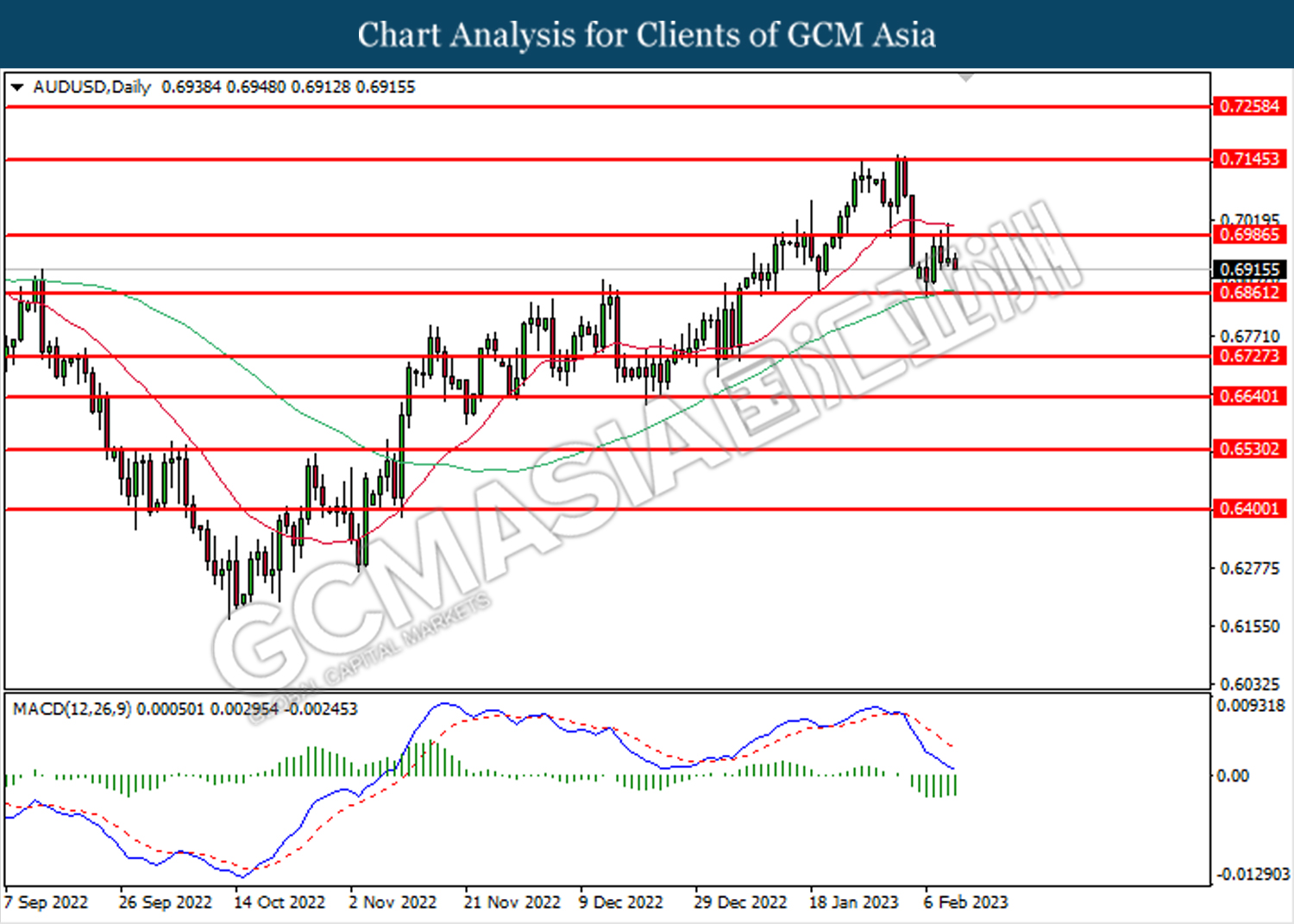

As one of the major currencies in the world, the Aussie dollar has experienced a tremendous sell-off in the recent trading session as the Reserve Bank of Australia (RBA) loosen its monetary policy decision. The board members decided to increase the interest rate target by 25bp to 3.35% as they expected the inflation has reached its peak last year December. The board members also argued that aggressively increasing the rate will lead to high prices and wages, which would cause higher inflation in persistent. In addition, a sharp drop in energy prices, due to lower energy demand in Europe following the winter weather, is expected to ease inflation. However, the bearish momentum of the Aussie dollar was offset by positive economic data. The unemployment rate in Australia was at its lowest level in nearly 50 years and thus, increased the space for further RBA tightening decisions. Some of the board members argued that the inflation in Australia remains high and still far away from the RBA’s target of 2% to 3%. The board agreed that further increases in the interest rate are needed to ensure that the inflation rate returns to its target. As of writing, the AUD/USD slipped by -0.20% to $0.6891.

In the commodity market, the crude oil price depreciated by -1.14% to $76.53 per barrel amid investors’ anticipation for more cues from Fed. Besides that, the gold price dropped by -0.17% to $1847.15 per troy ounce as of writing amid investors’ anticipates for more rate hikes for Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 47.3 | 47.8 | – |

| 17:30 | GBP – Composite PMI | 48.5 | – | – |

| 17:30 | GBP – Manufacturing PMI | 47.0 | 47.5 | – |

| 17:30 | GBP – Services PMI | 48.7 | 49.2 | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 16.9 | 22.0 | – |

| 21:30 | CAD – Core CPI (MoM) (Jan) | -0.3% | 0.2% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | -0.6% | -0.1% | – |

| 23:00 | USD – Existing Home Sales (Jan) | 4.02M | 4.10M | – |

Technical Analysis

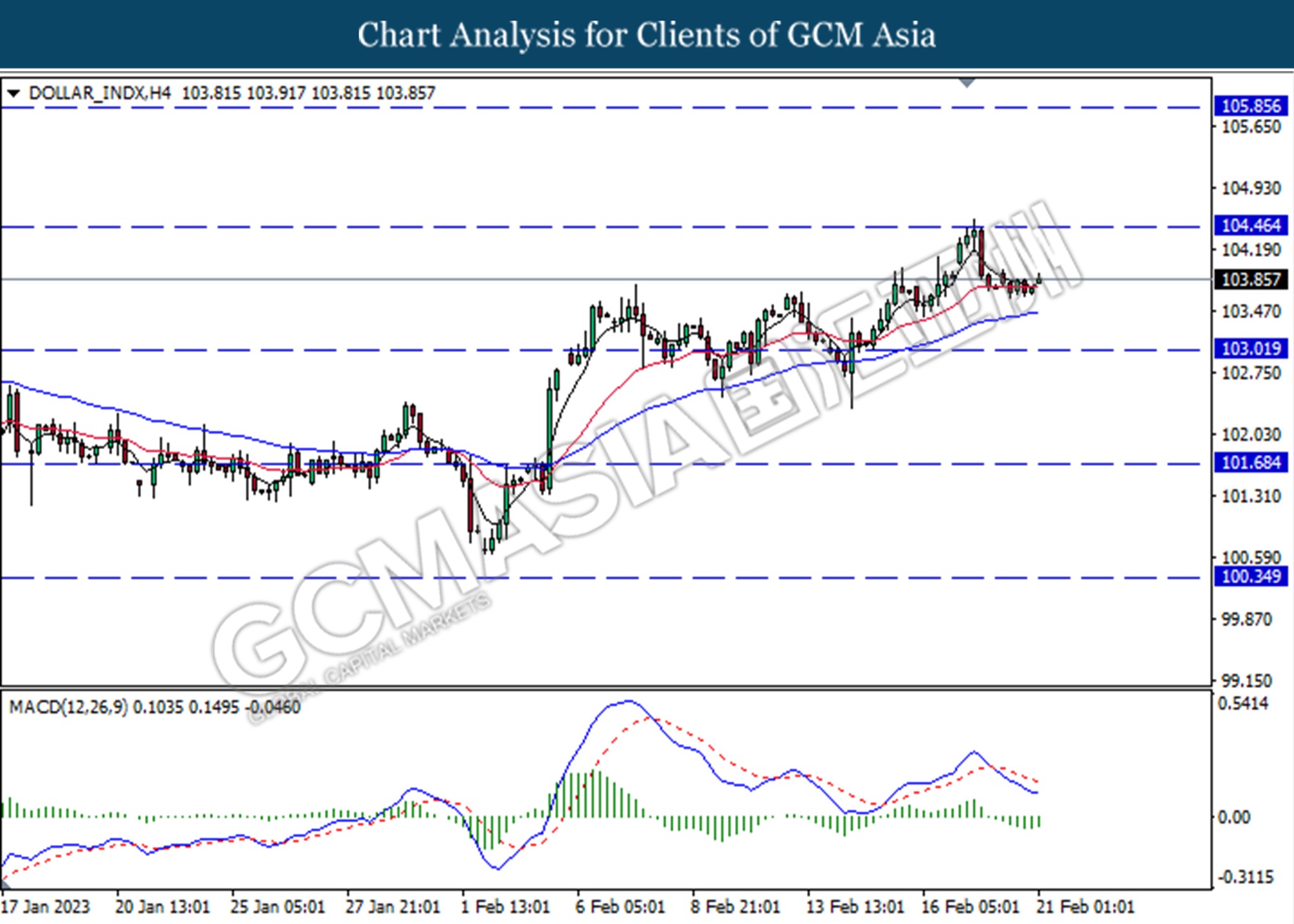

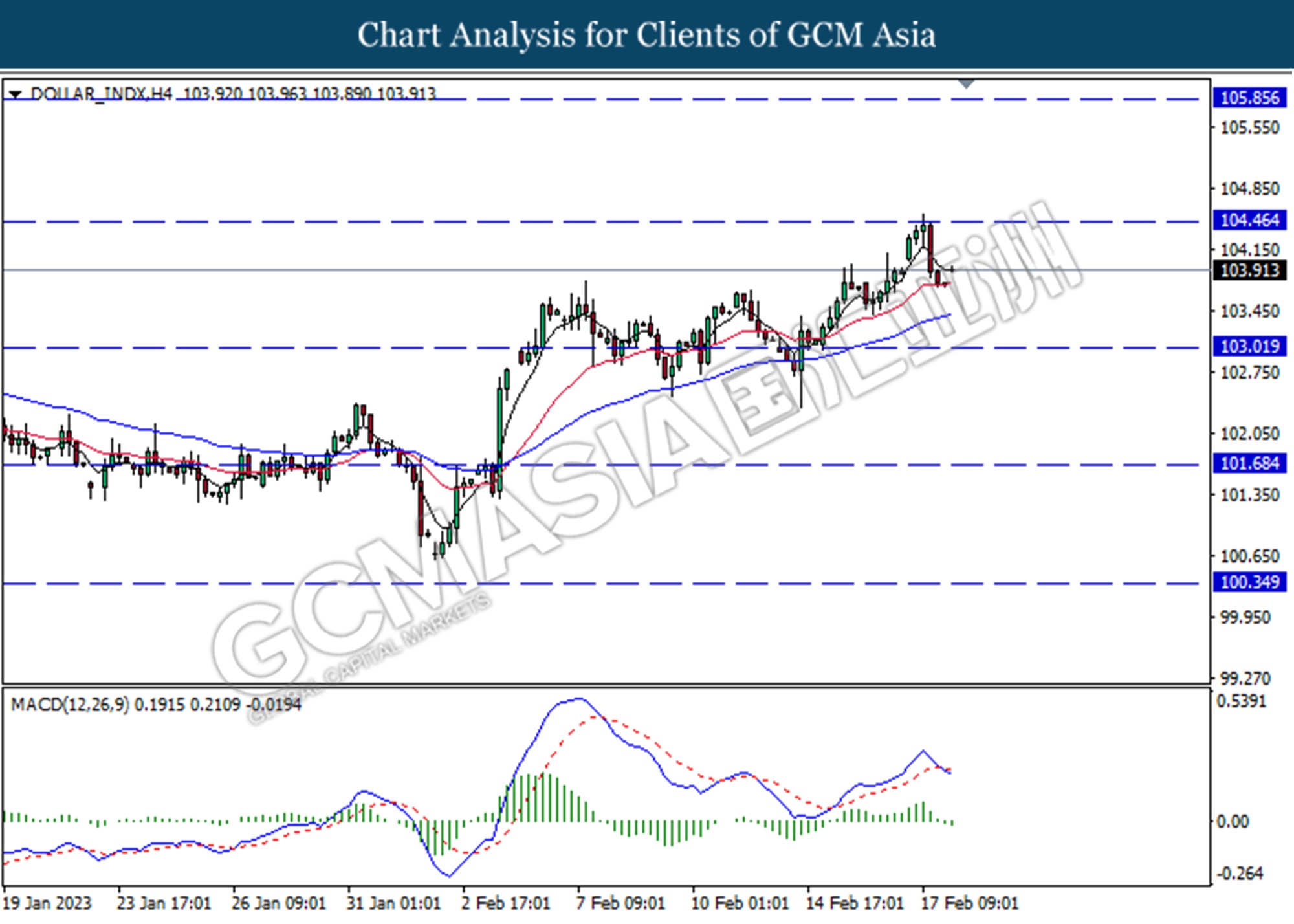

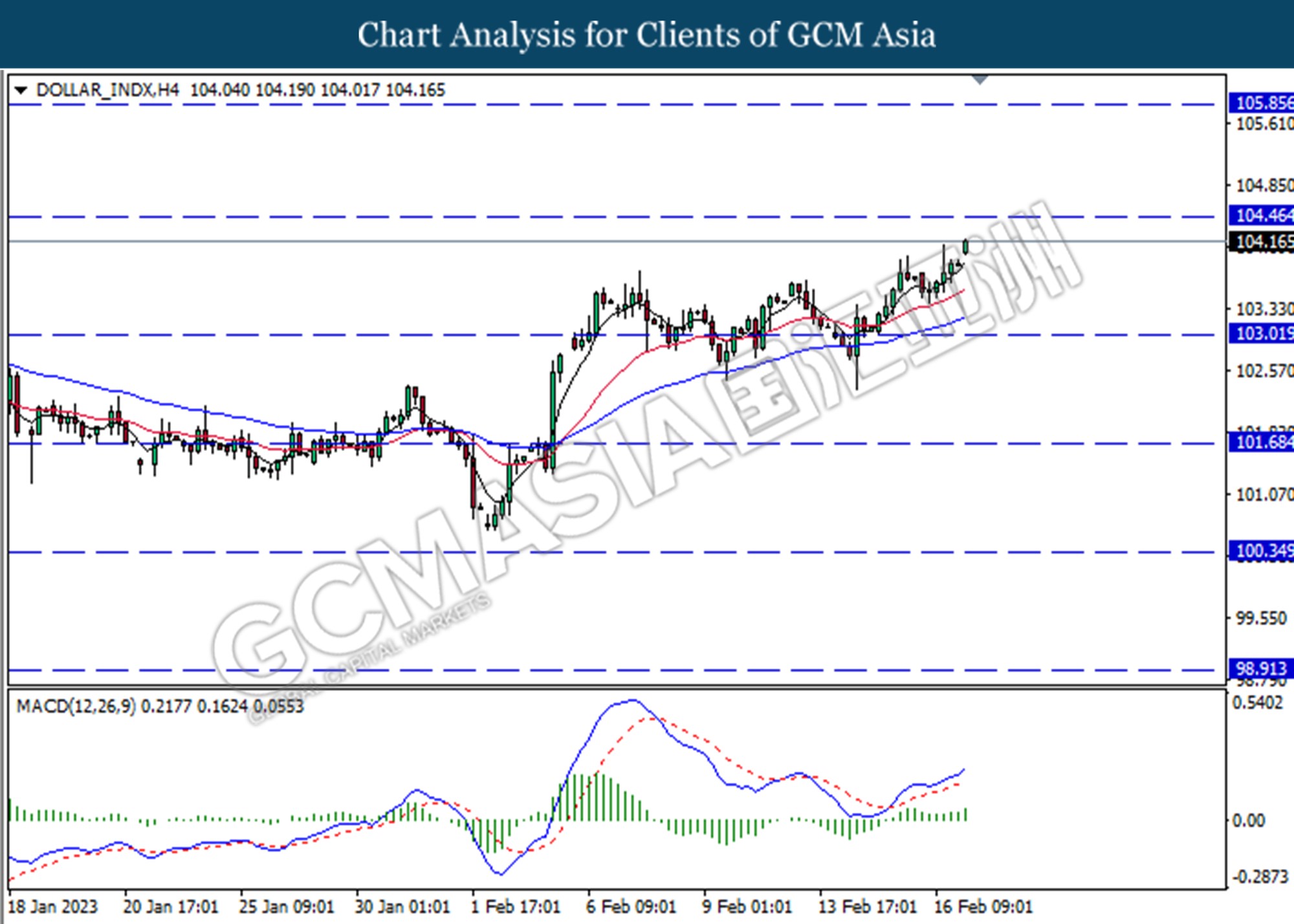

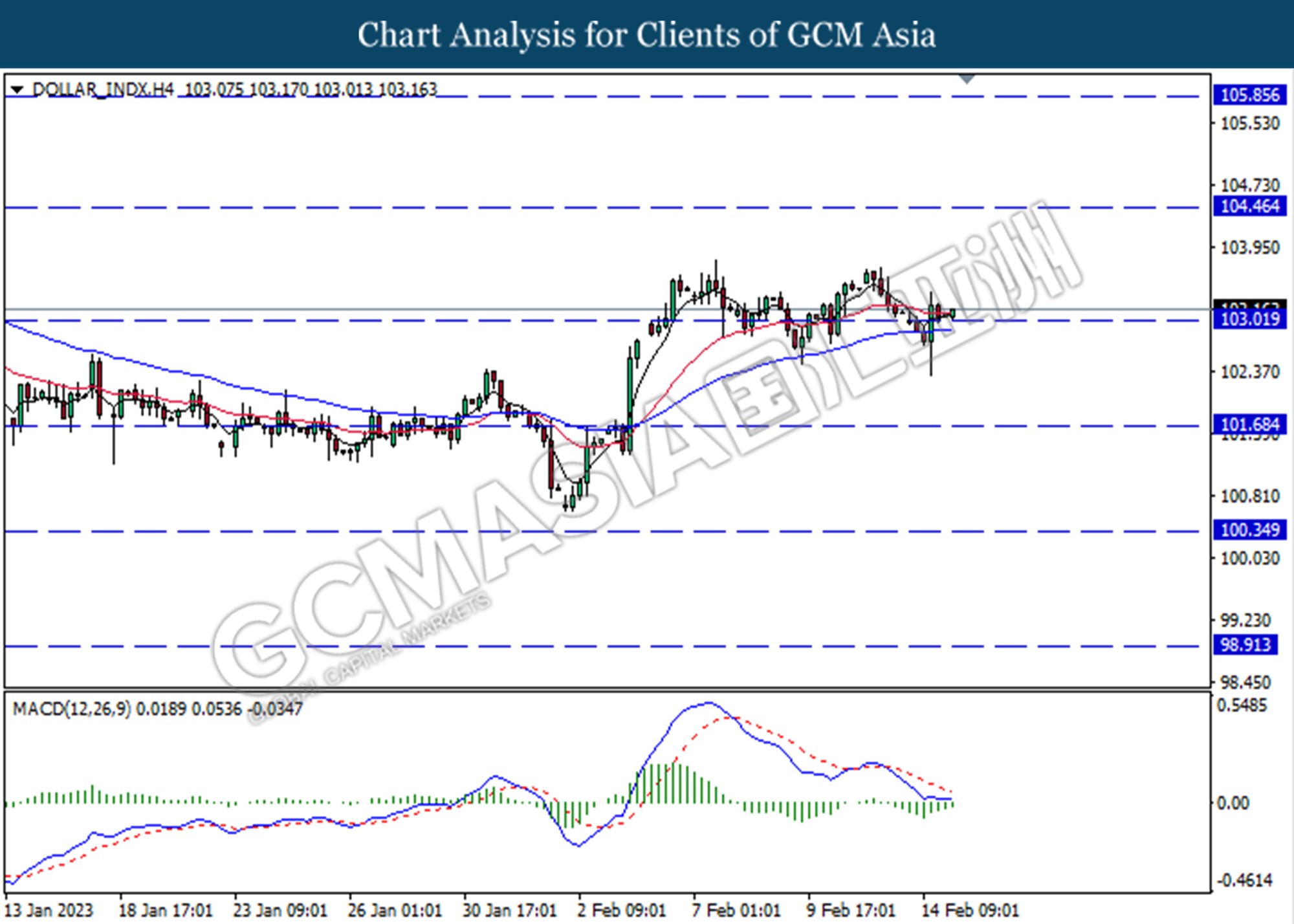

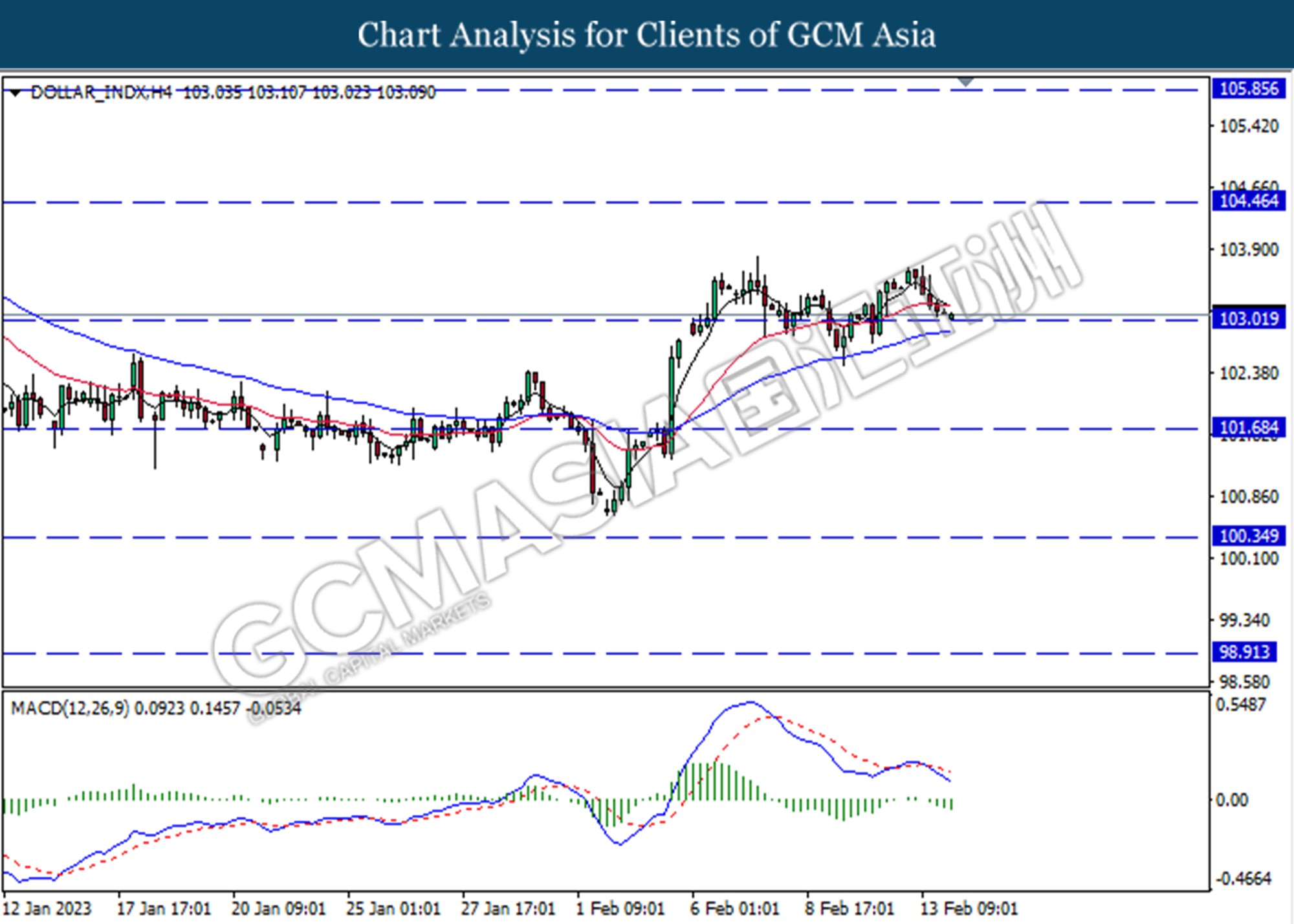

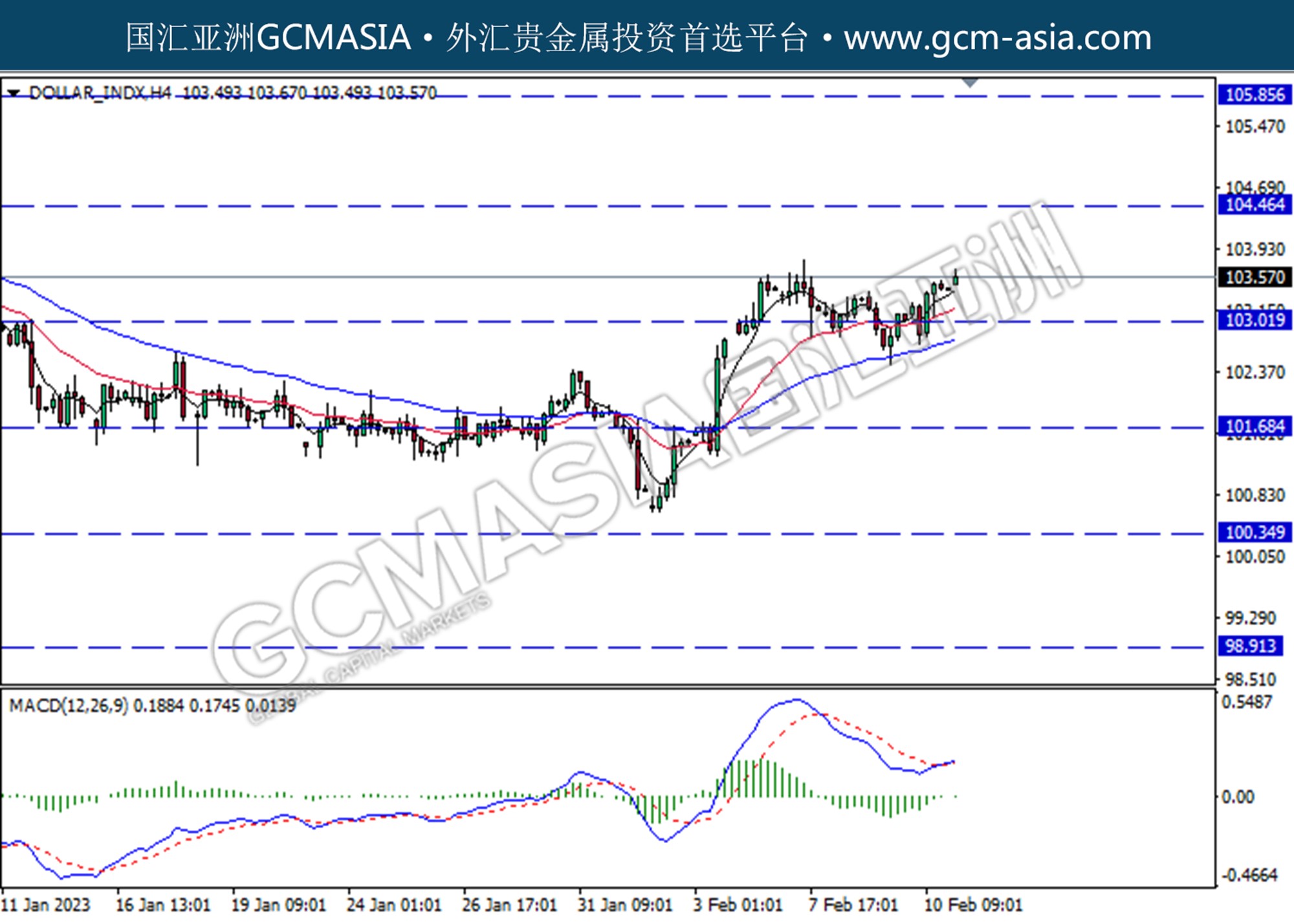

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lowest level. MACD which illustrated decreasing bearish momentum suggests the index to extend its gain toward the resistance level at 104.45

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

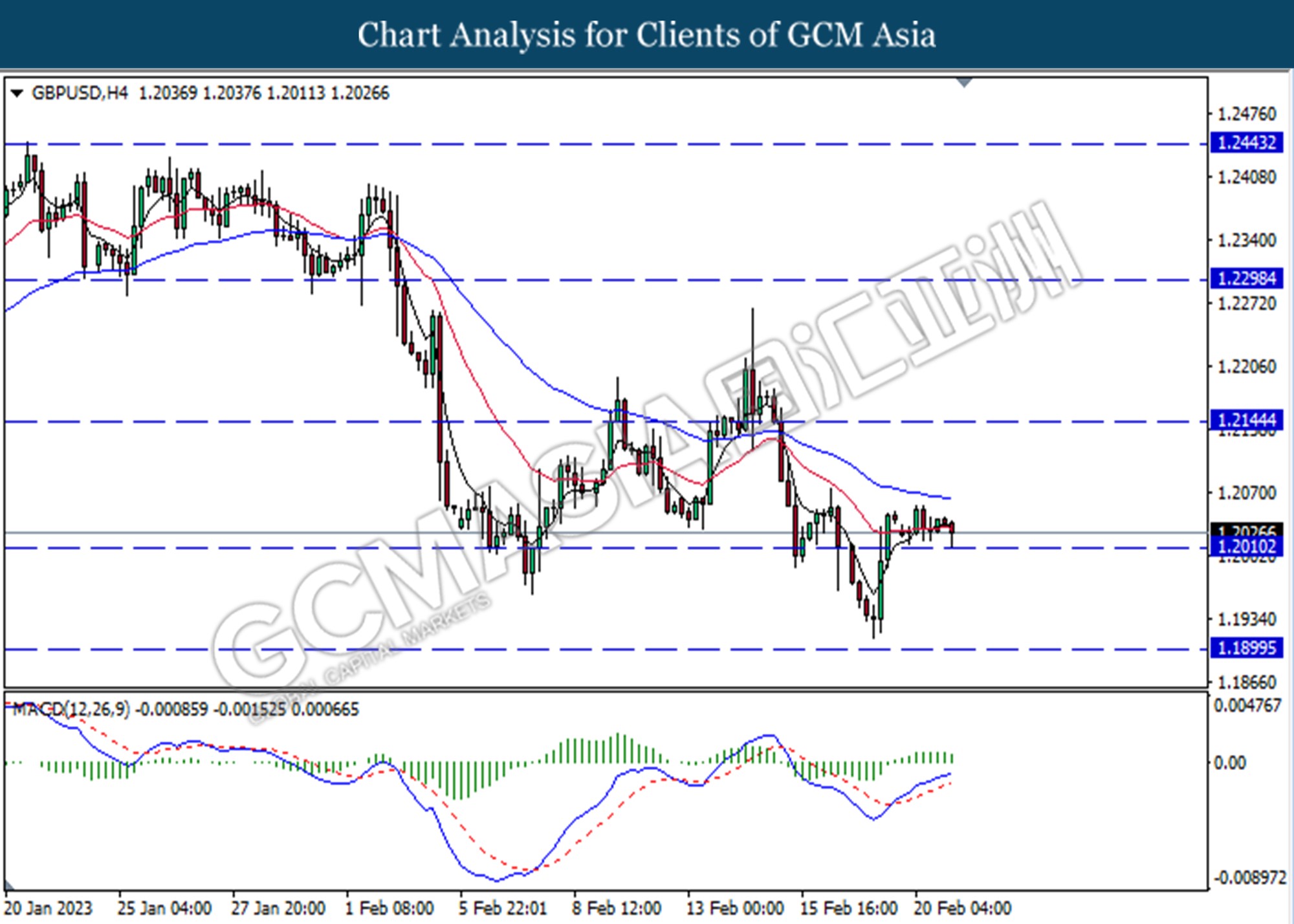

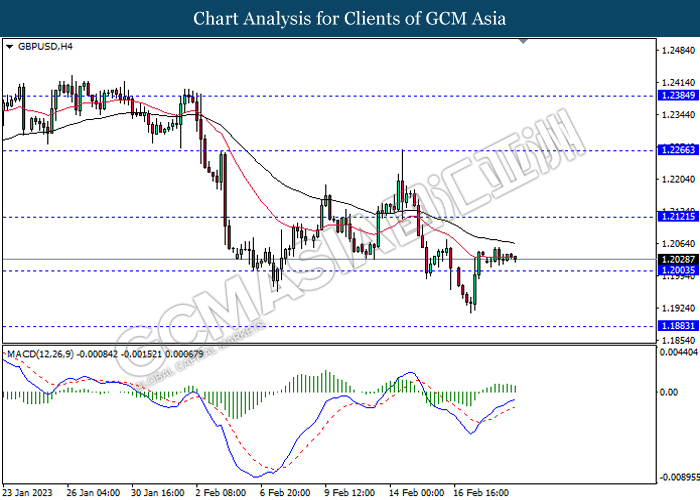

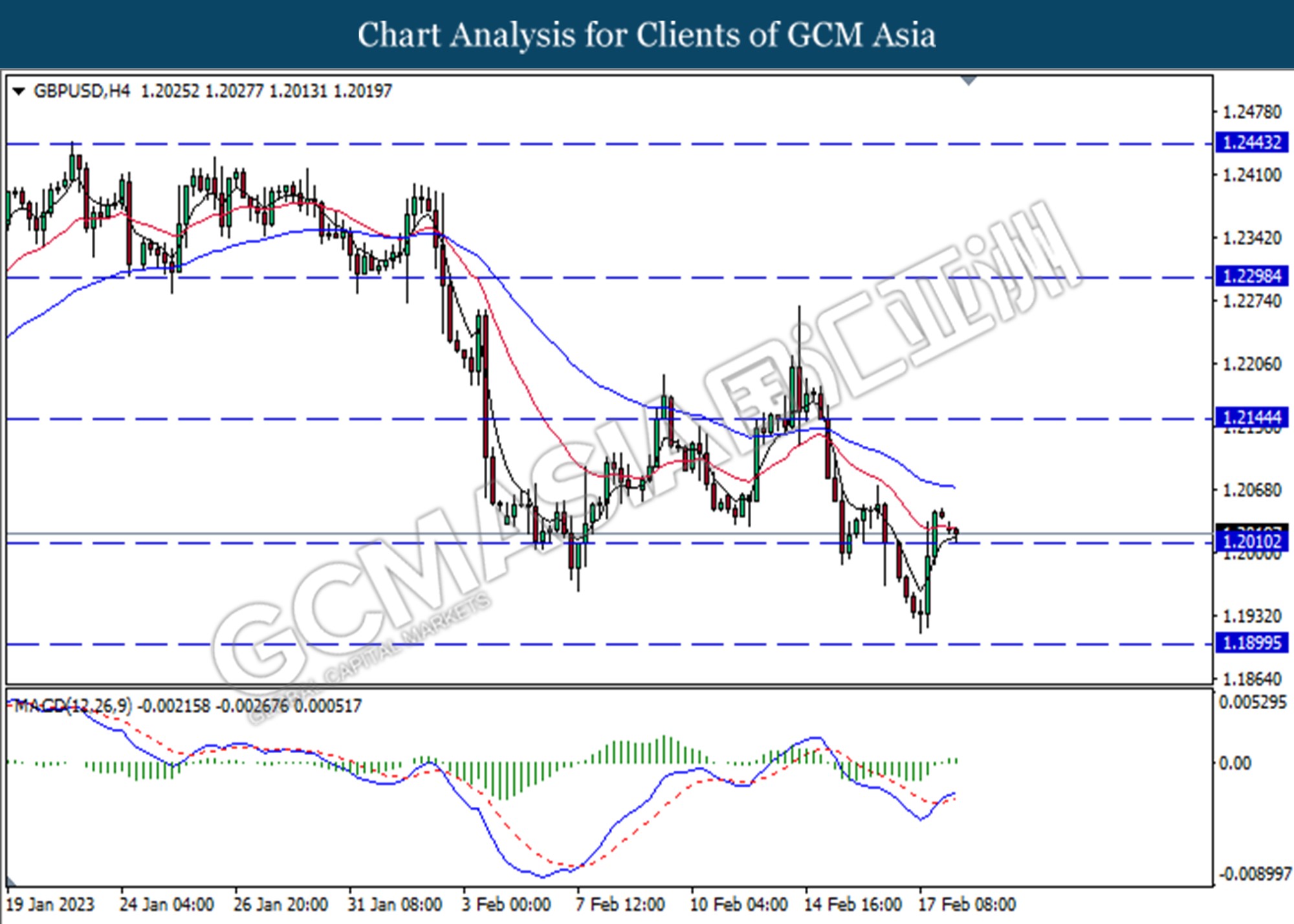

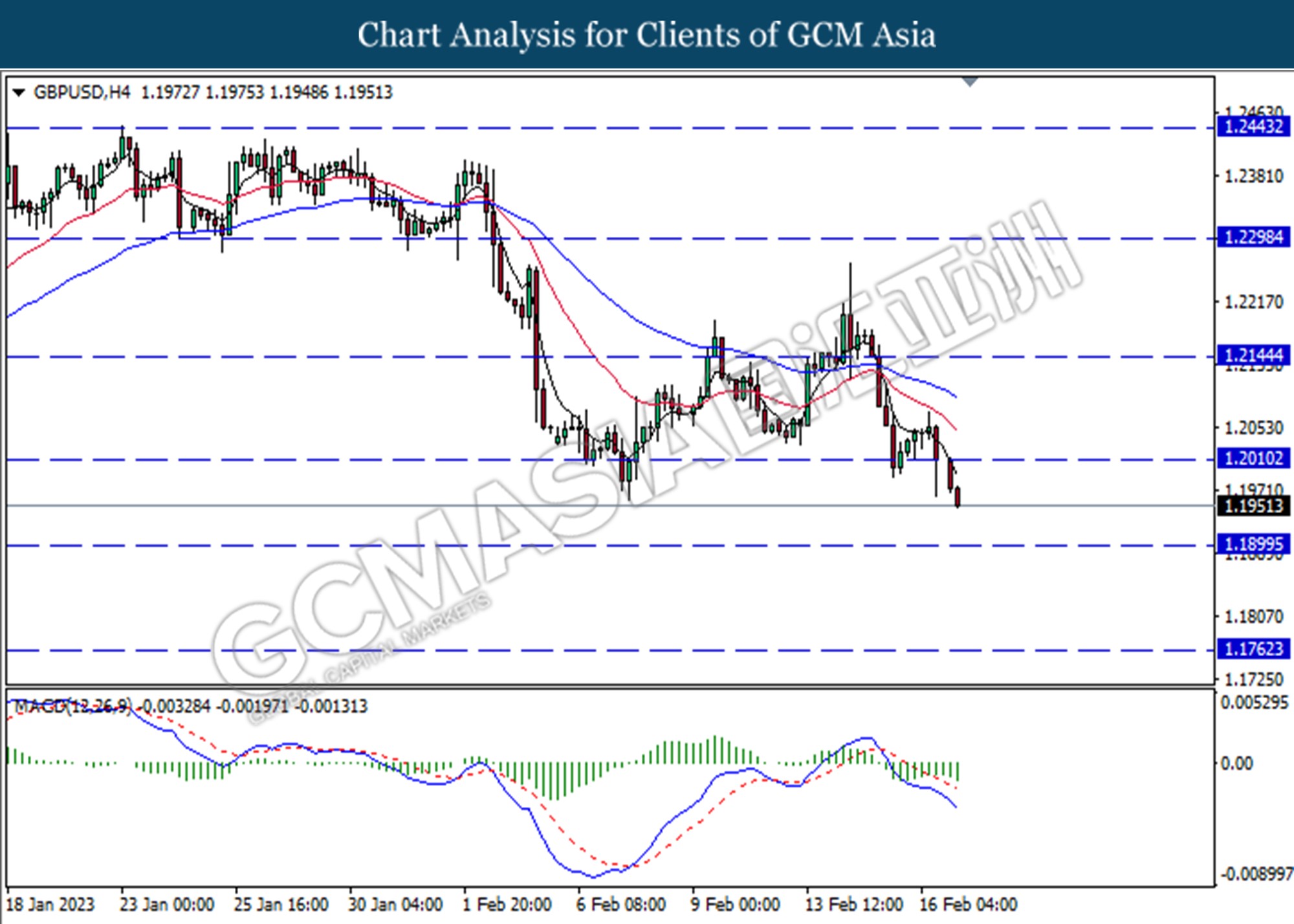

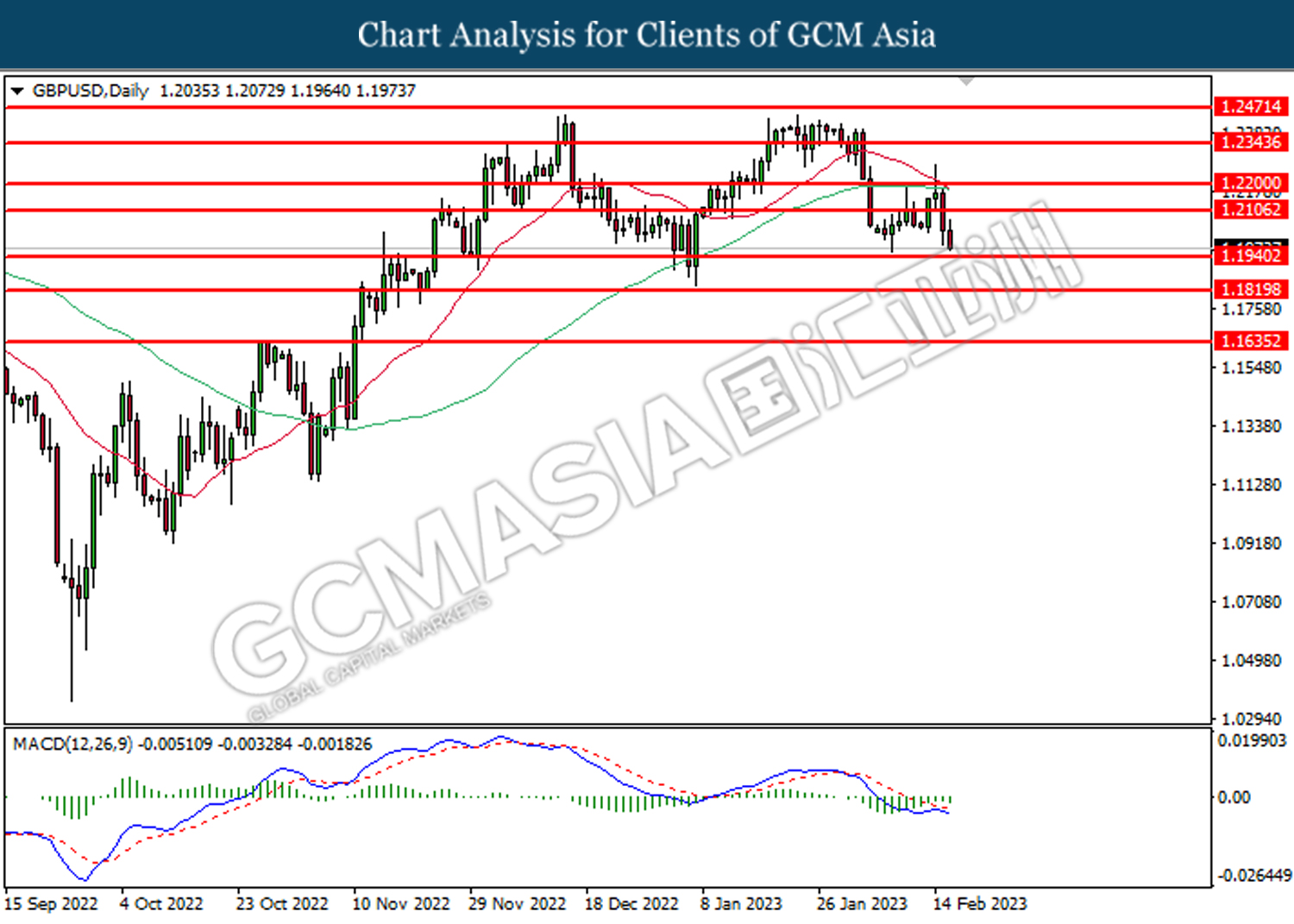

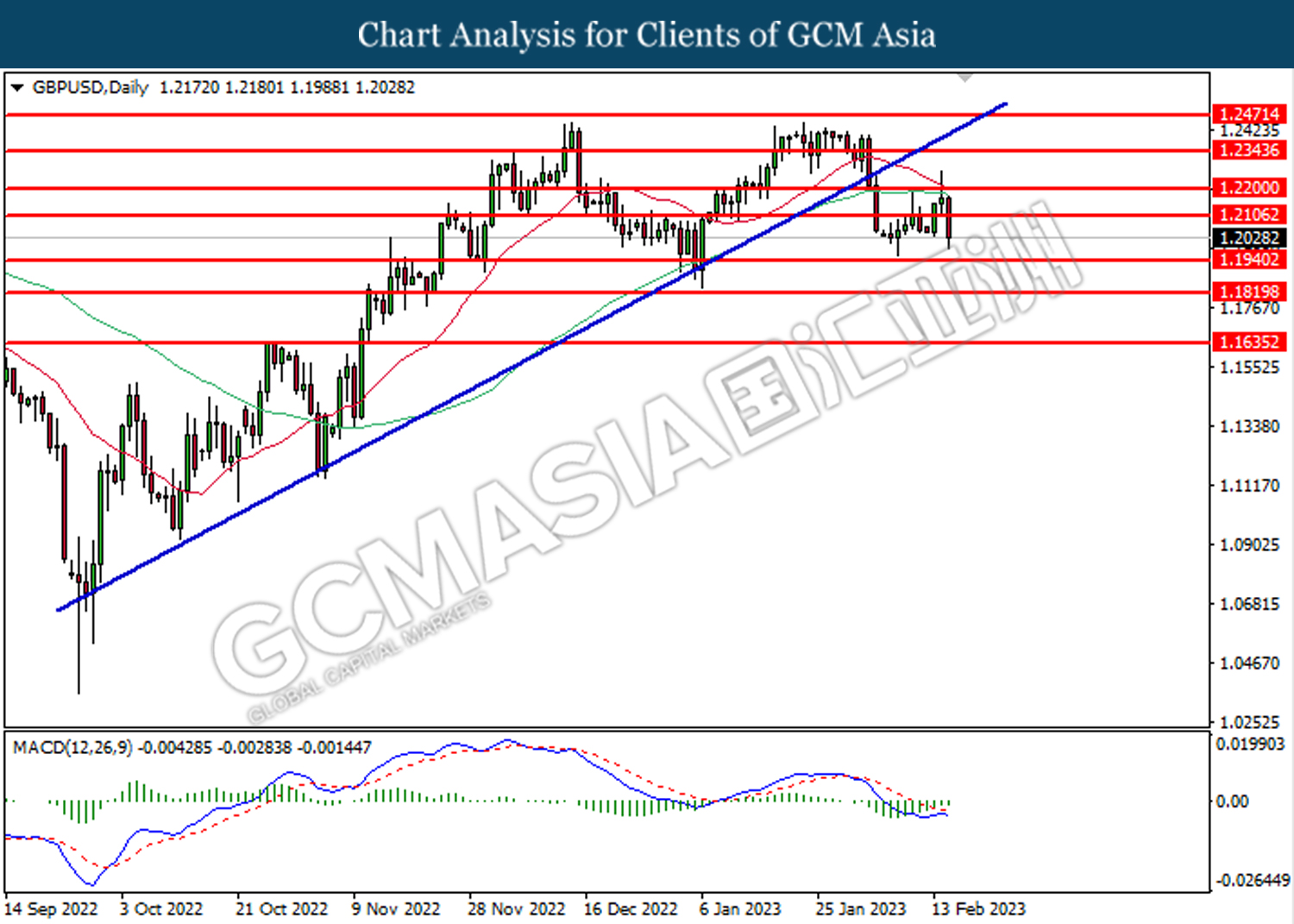

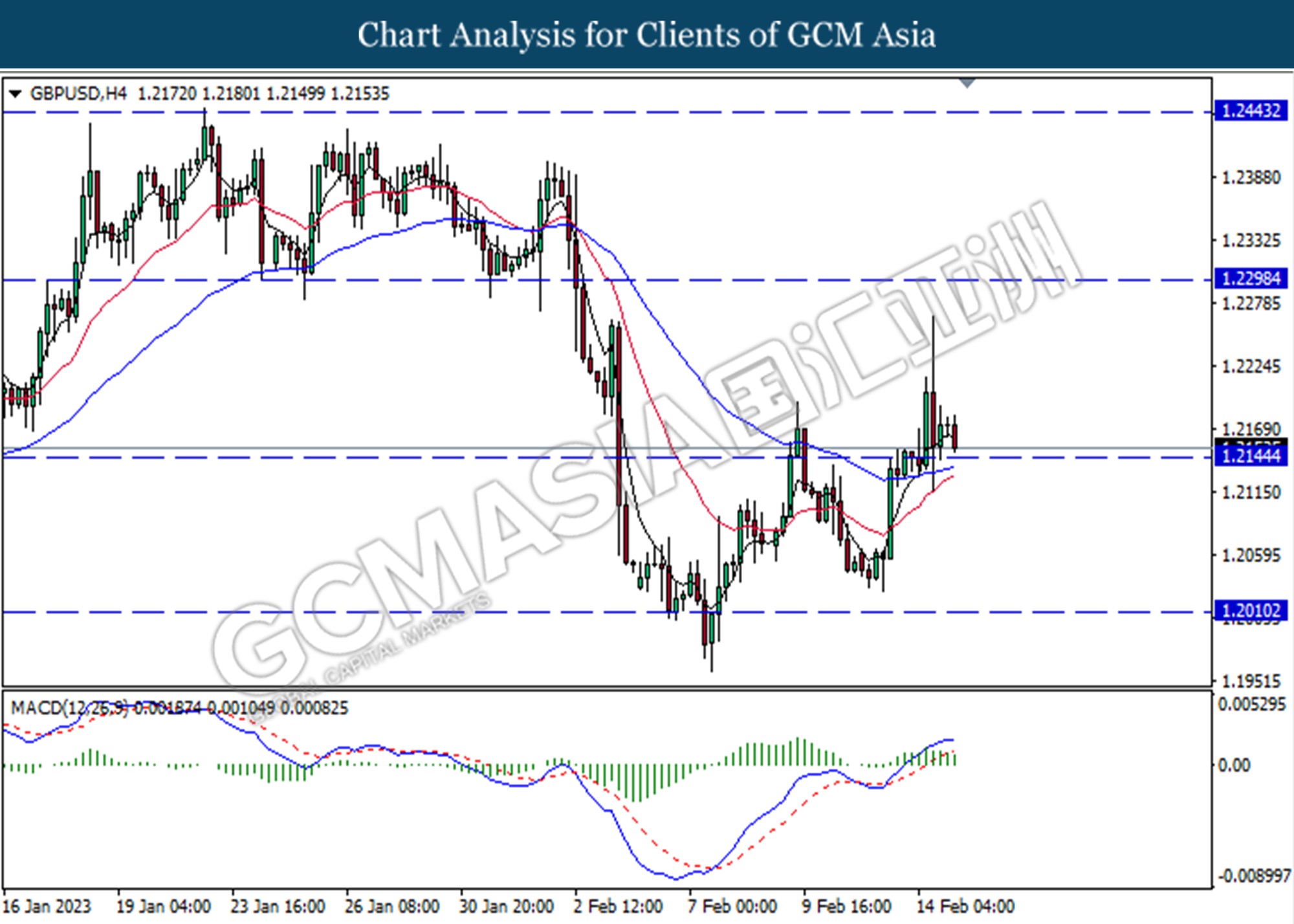

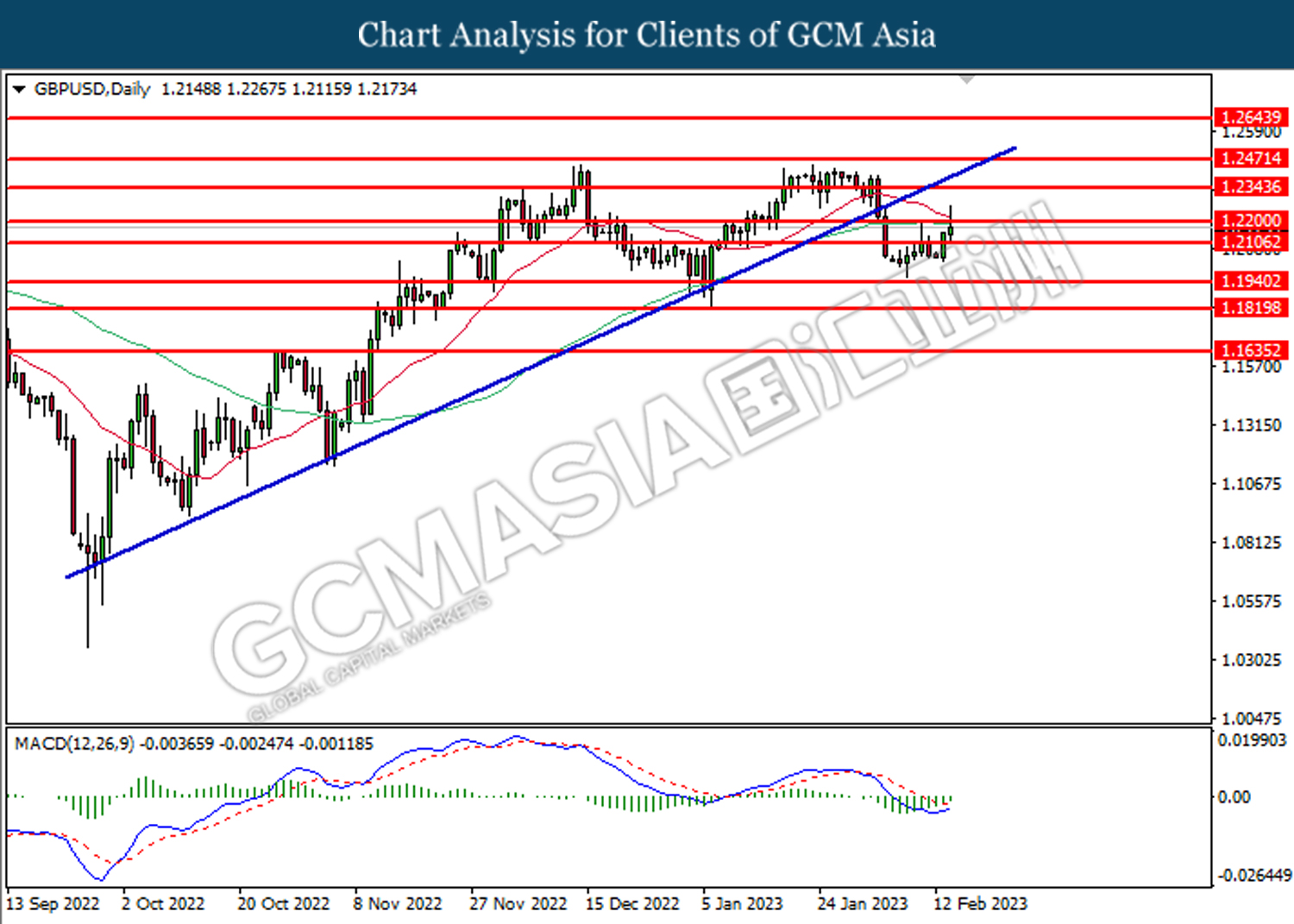

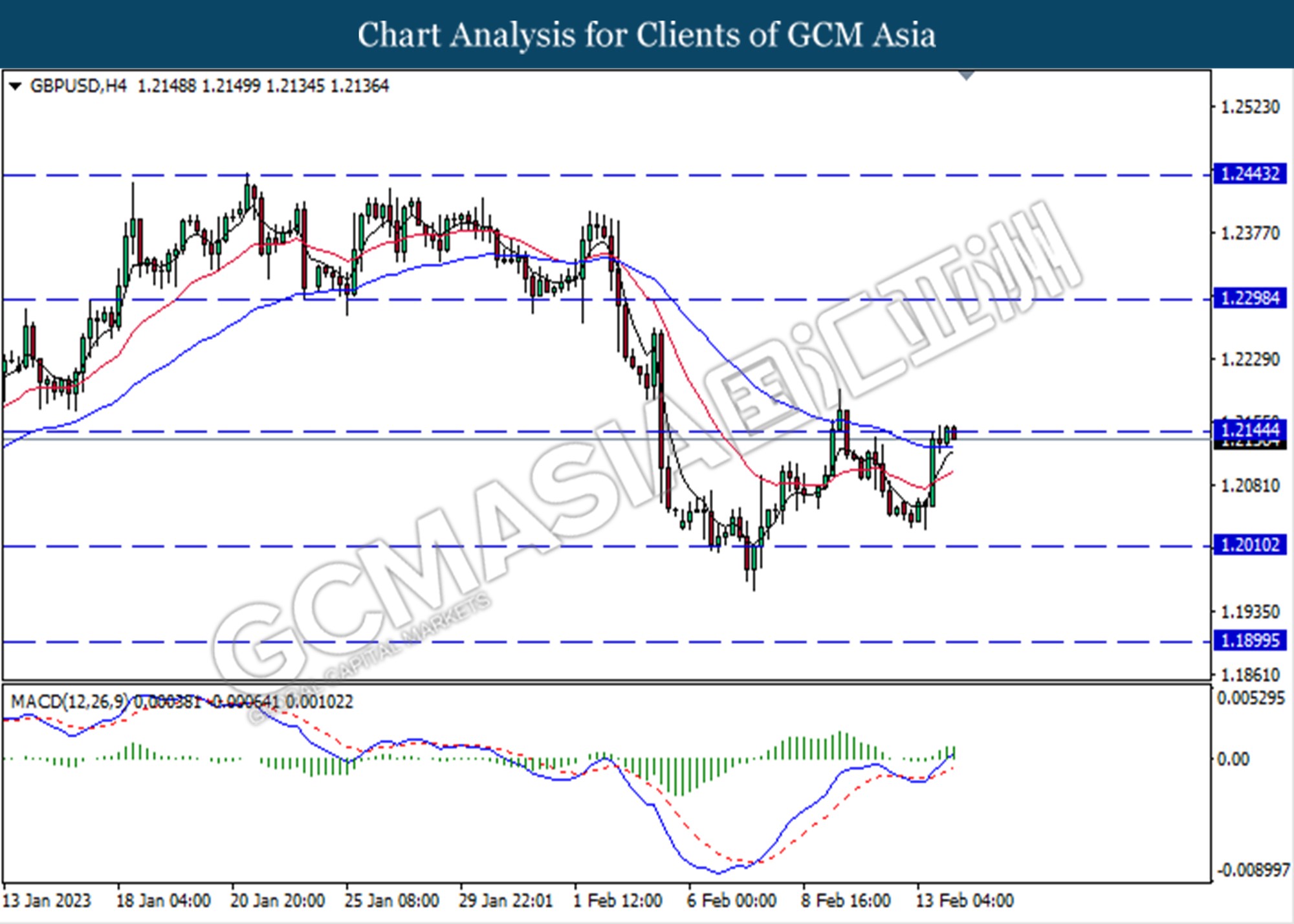

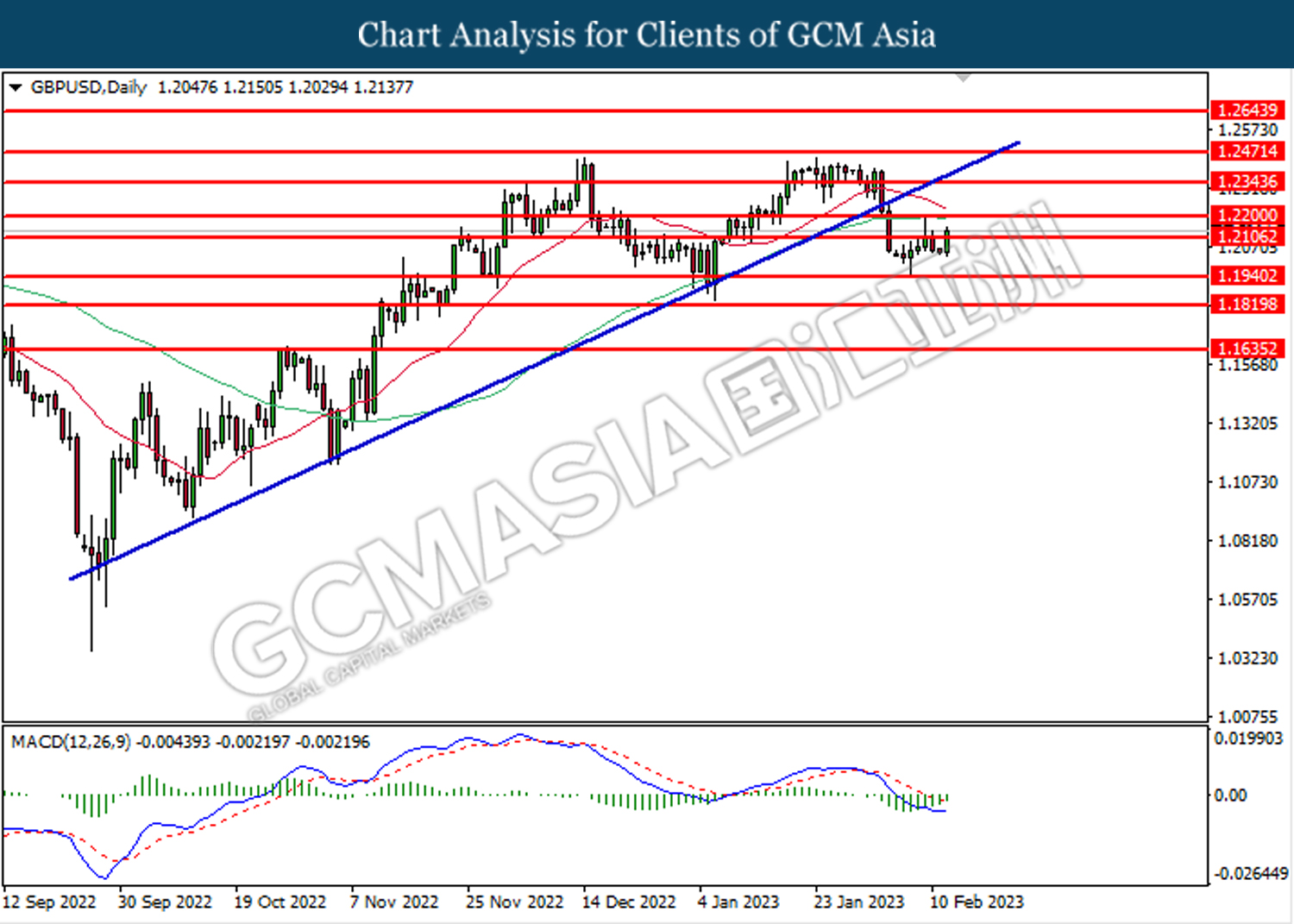

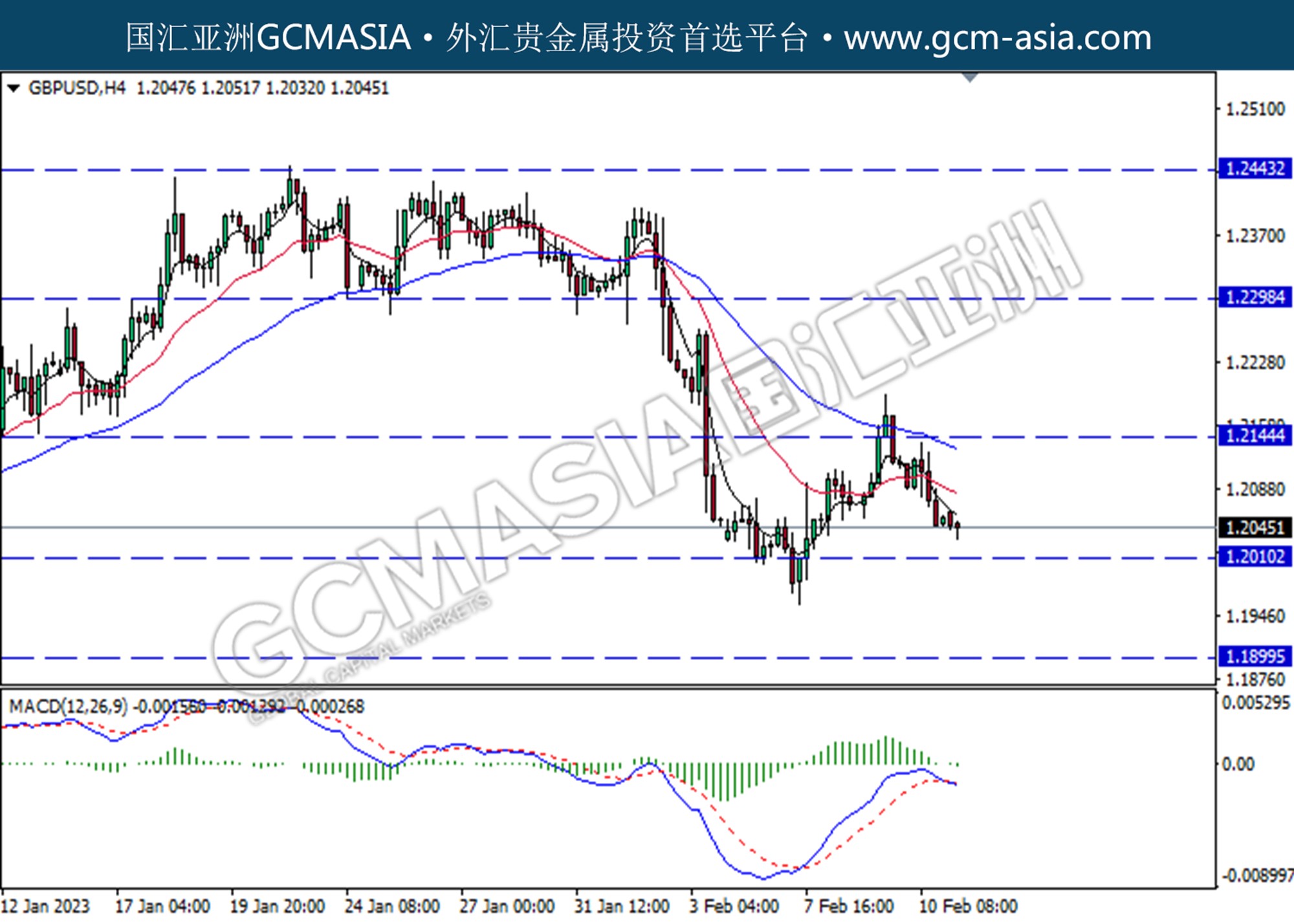

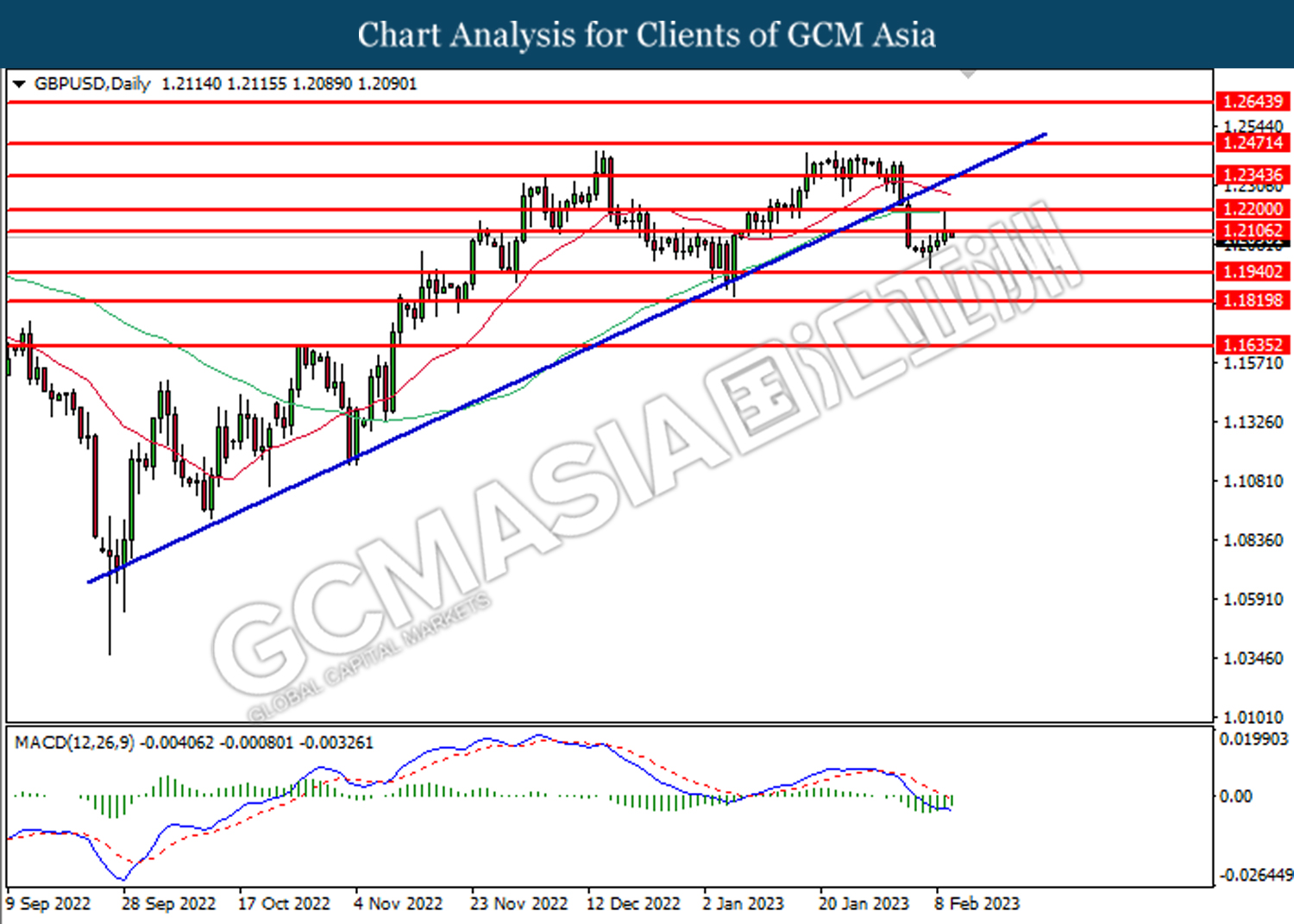

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2010. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses after it successfully breaks below the support level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

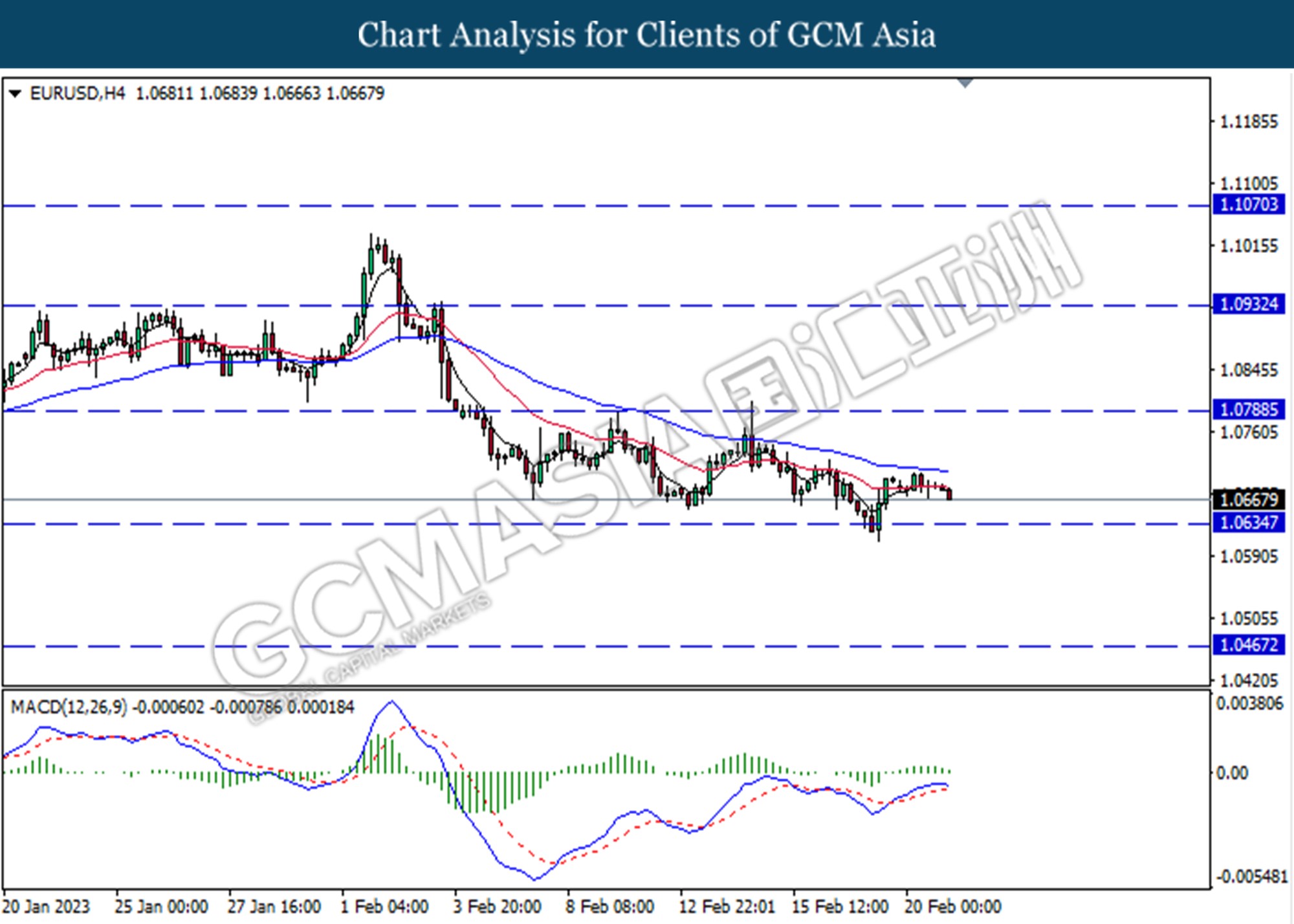

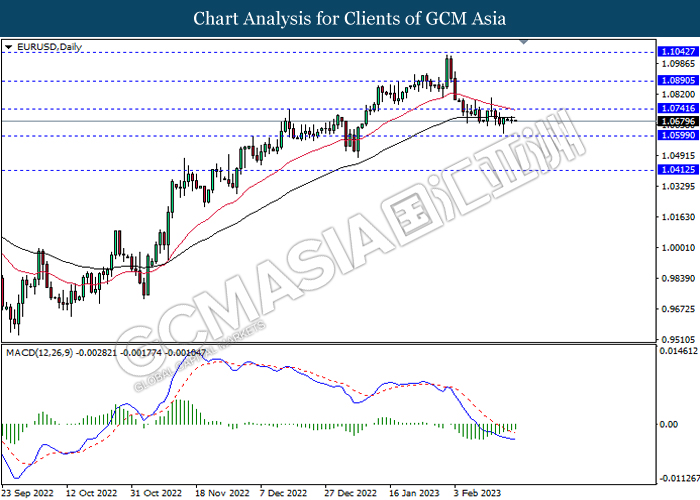

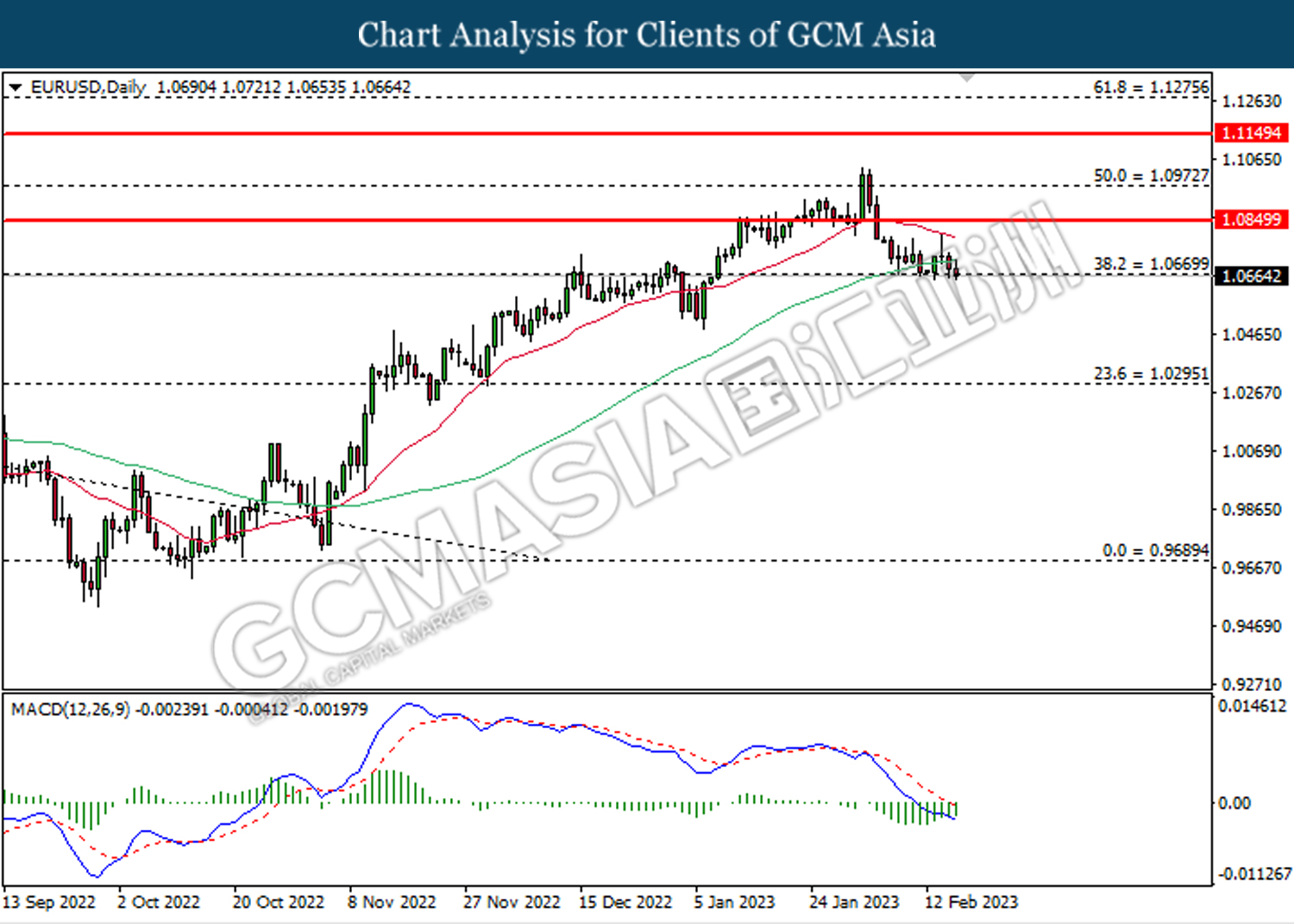

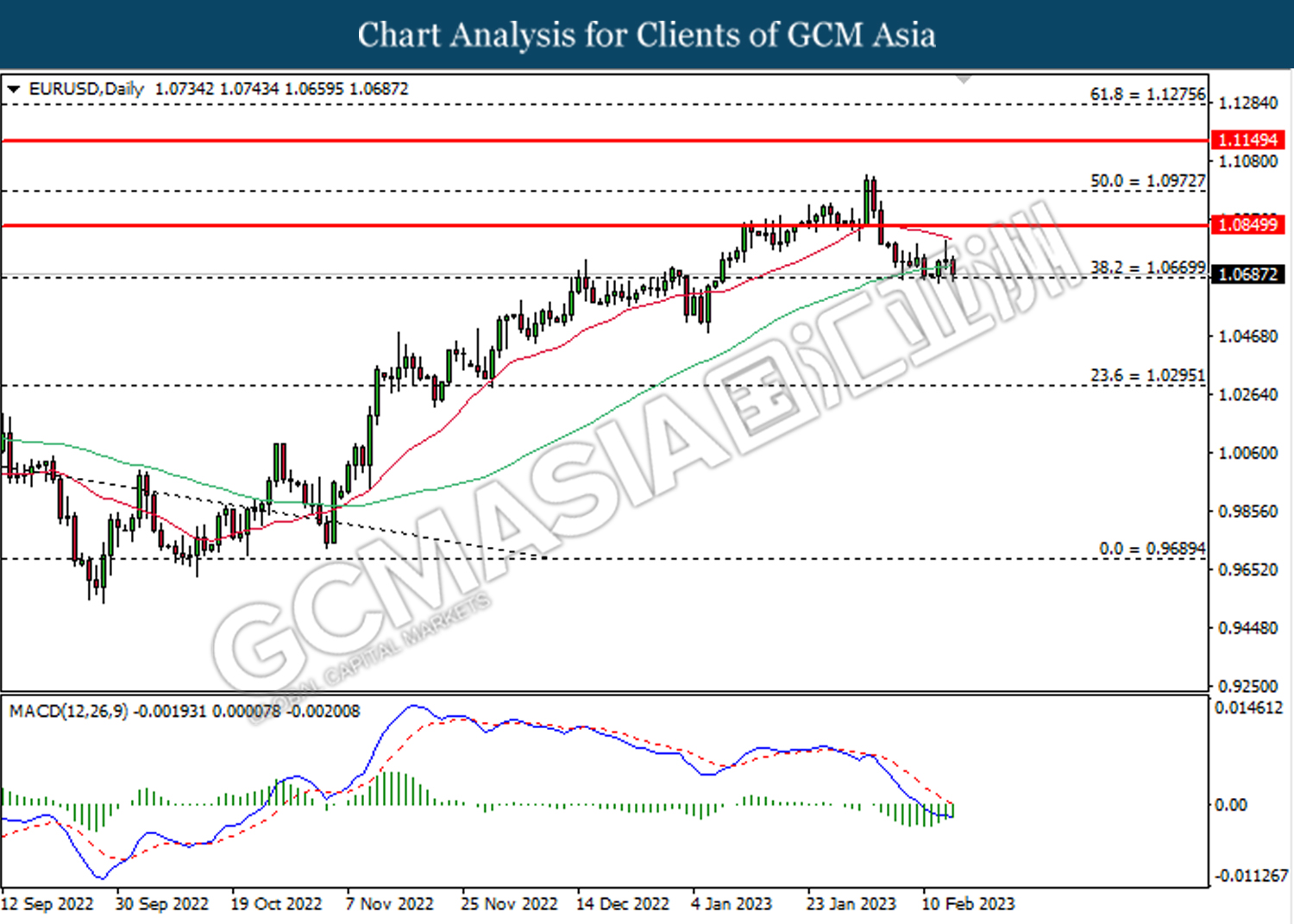

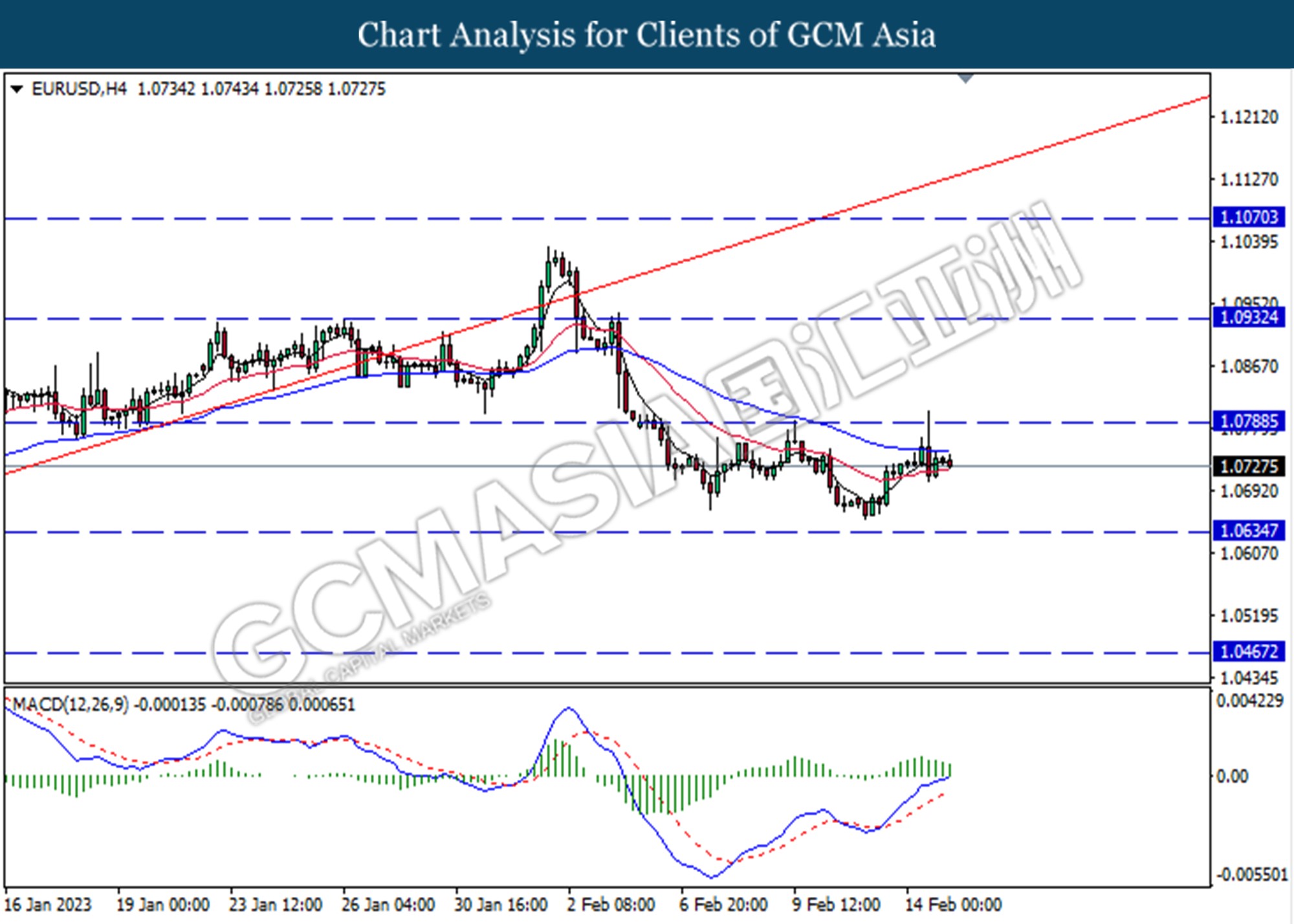

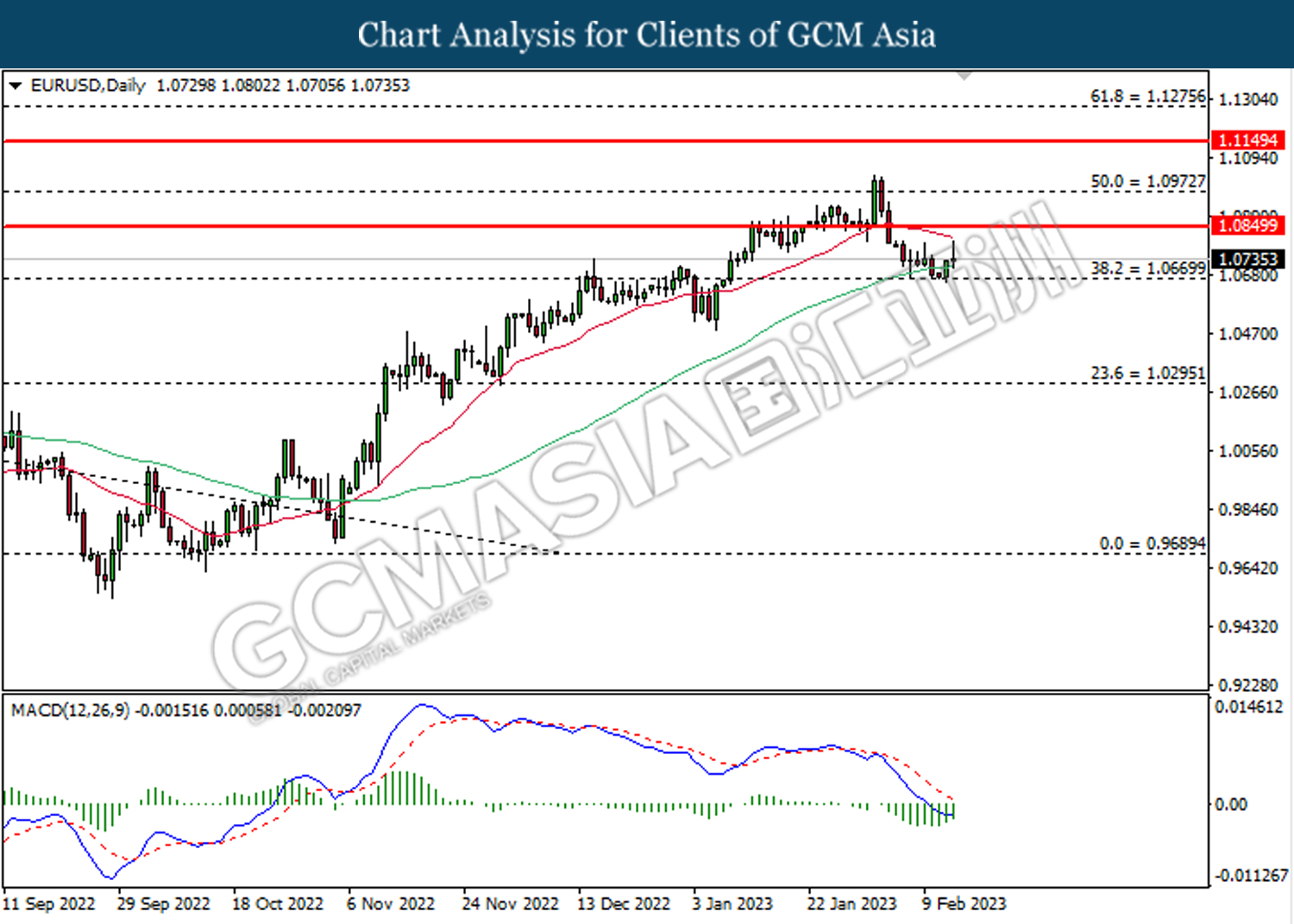

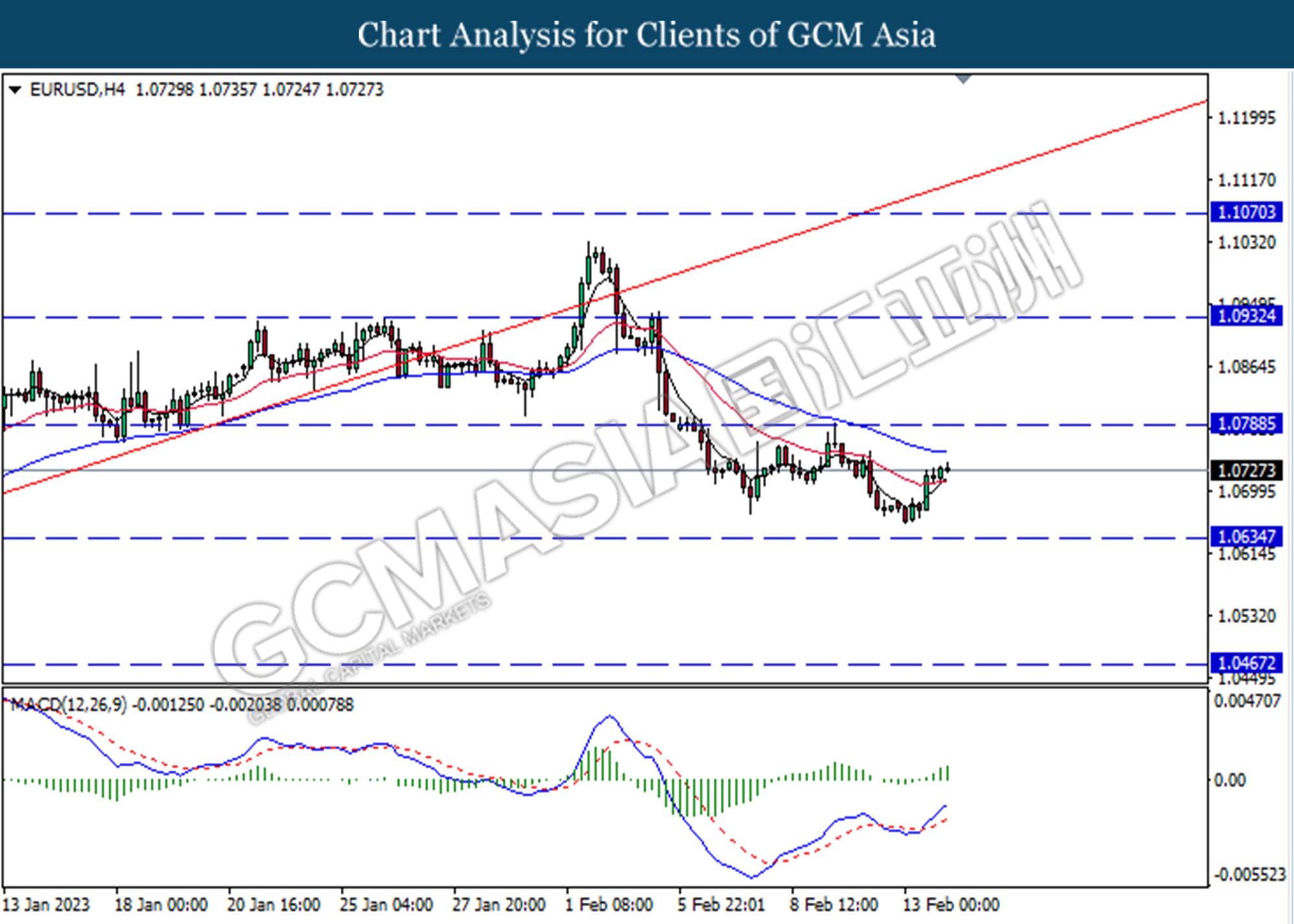

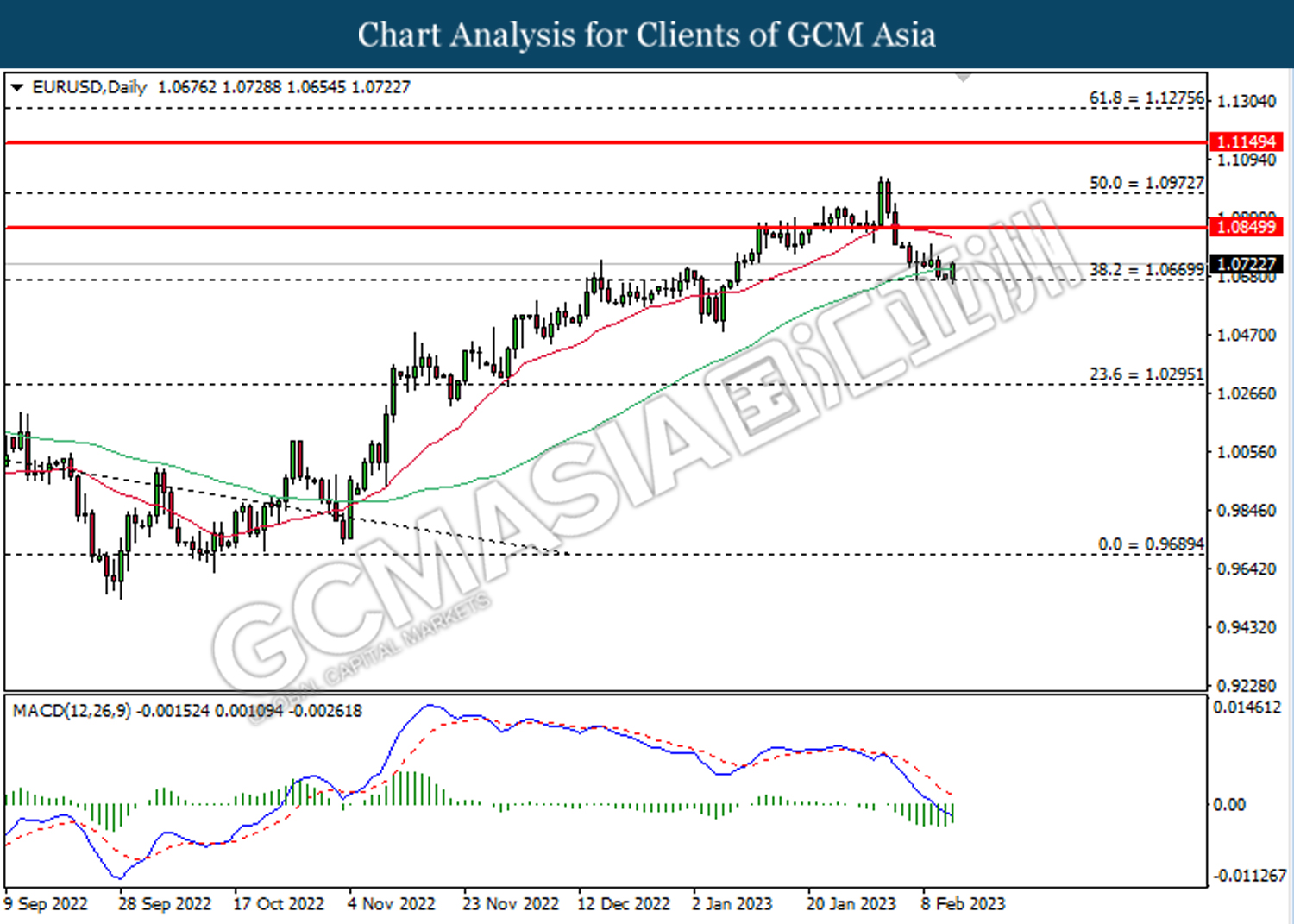

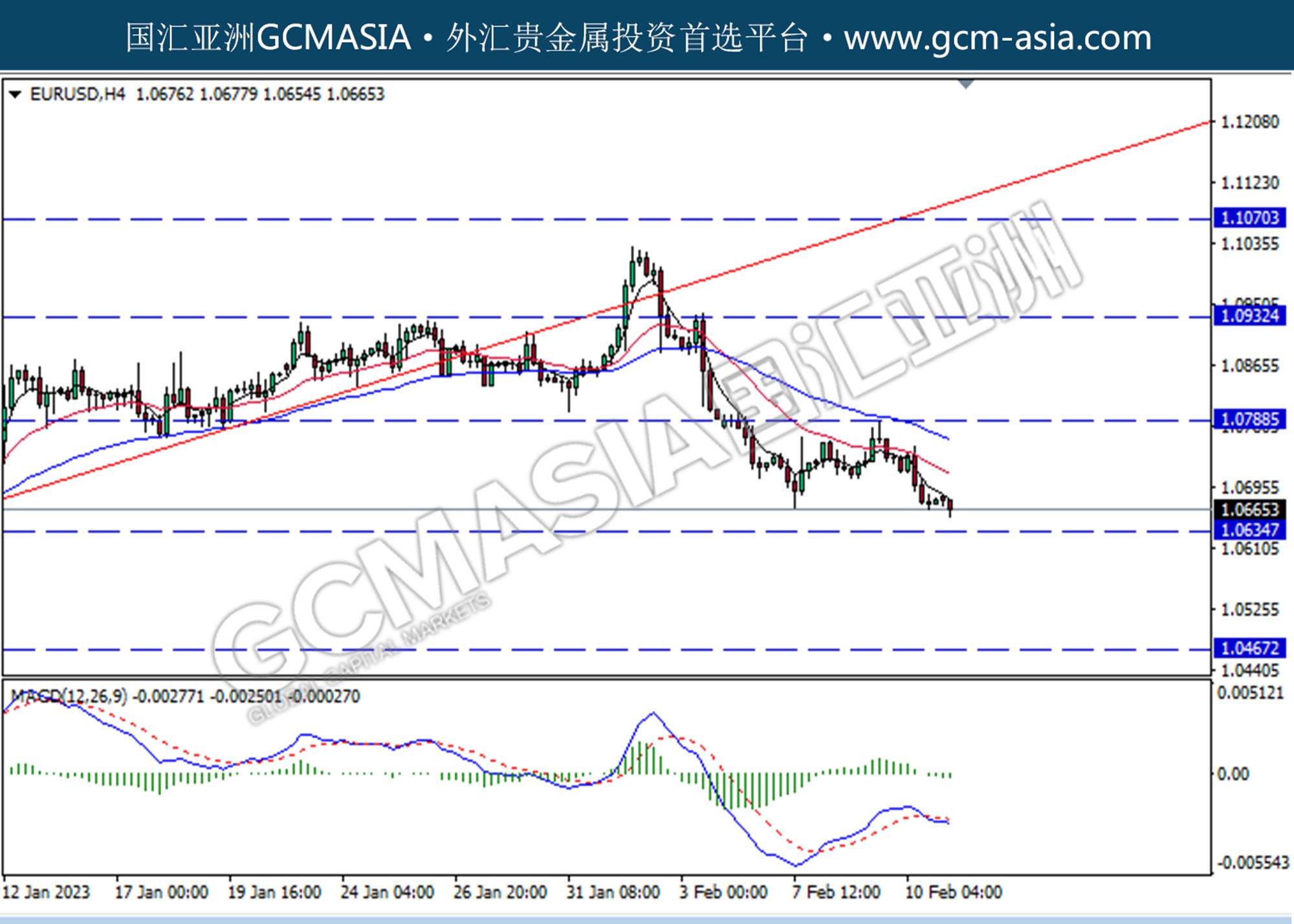

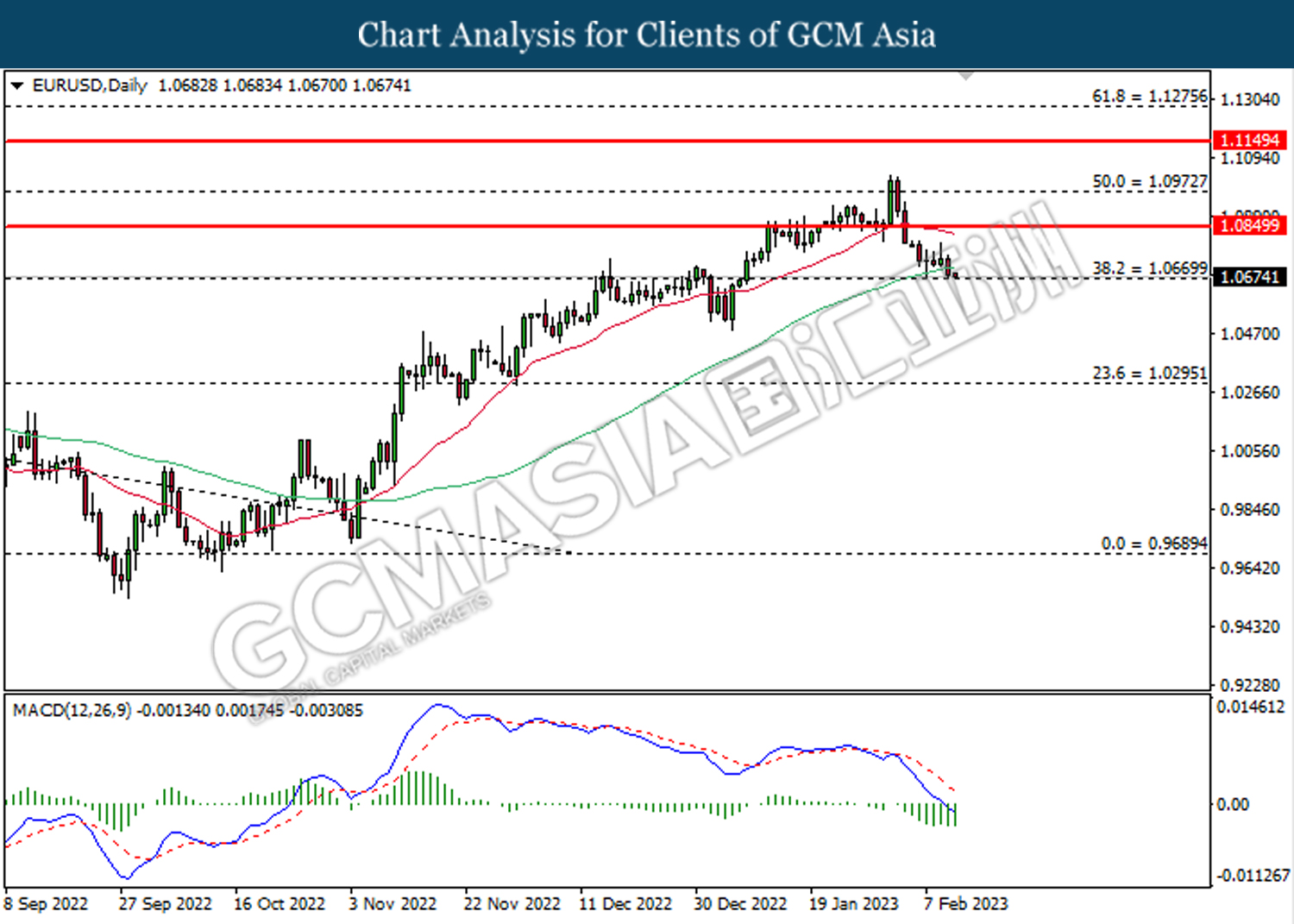

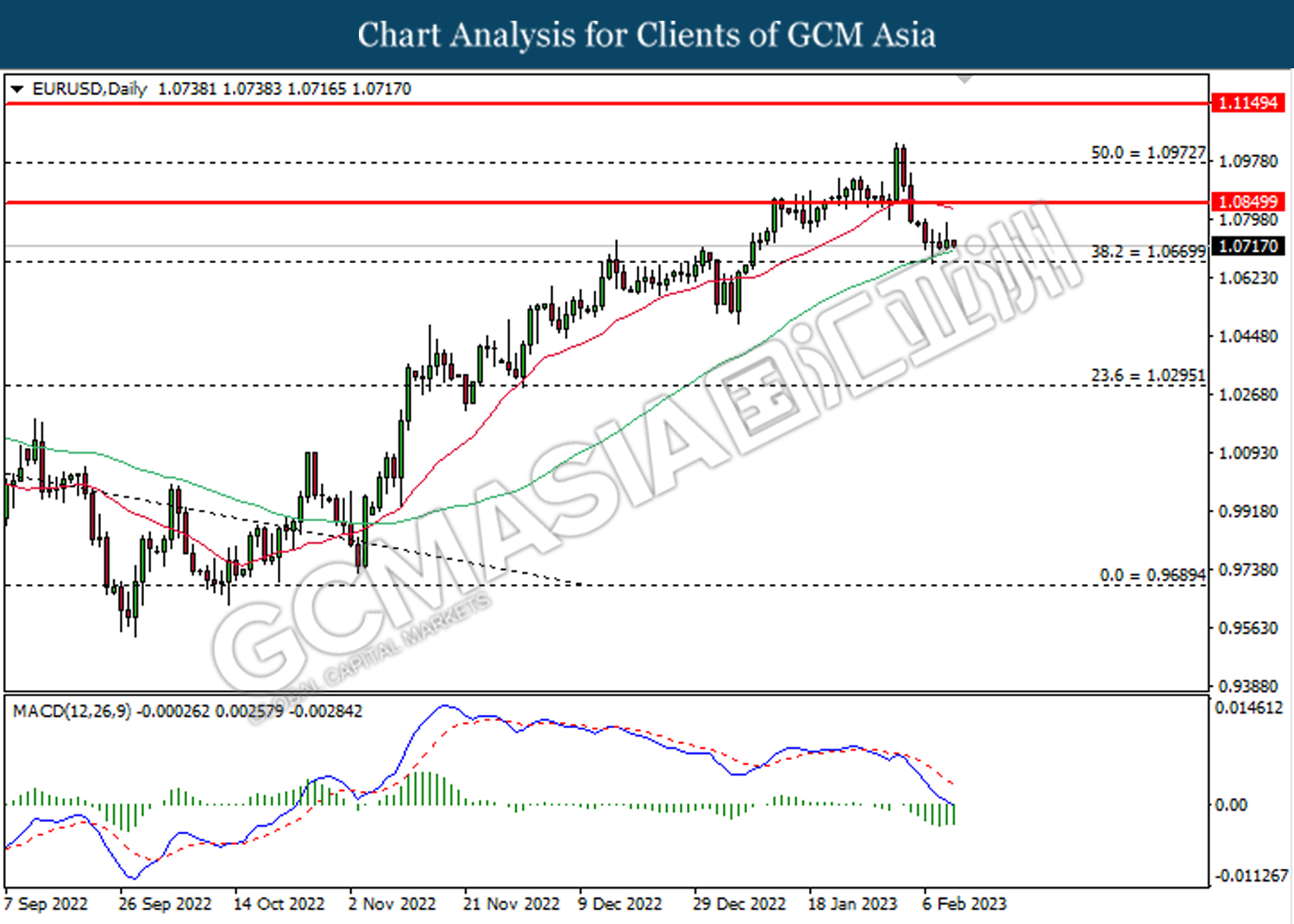

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0470

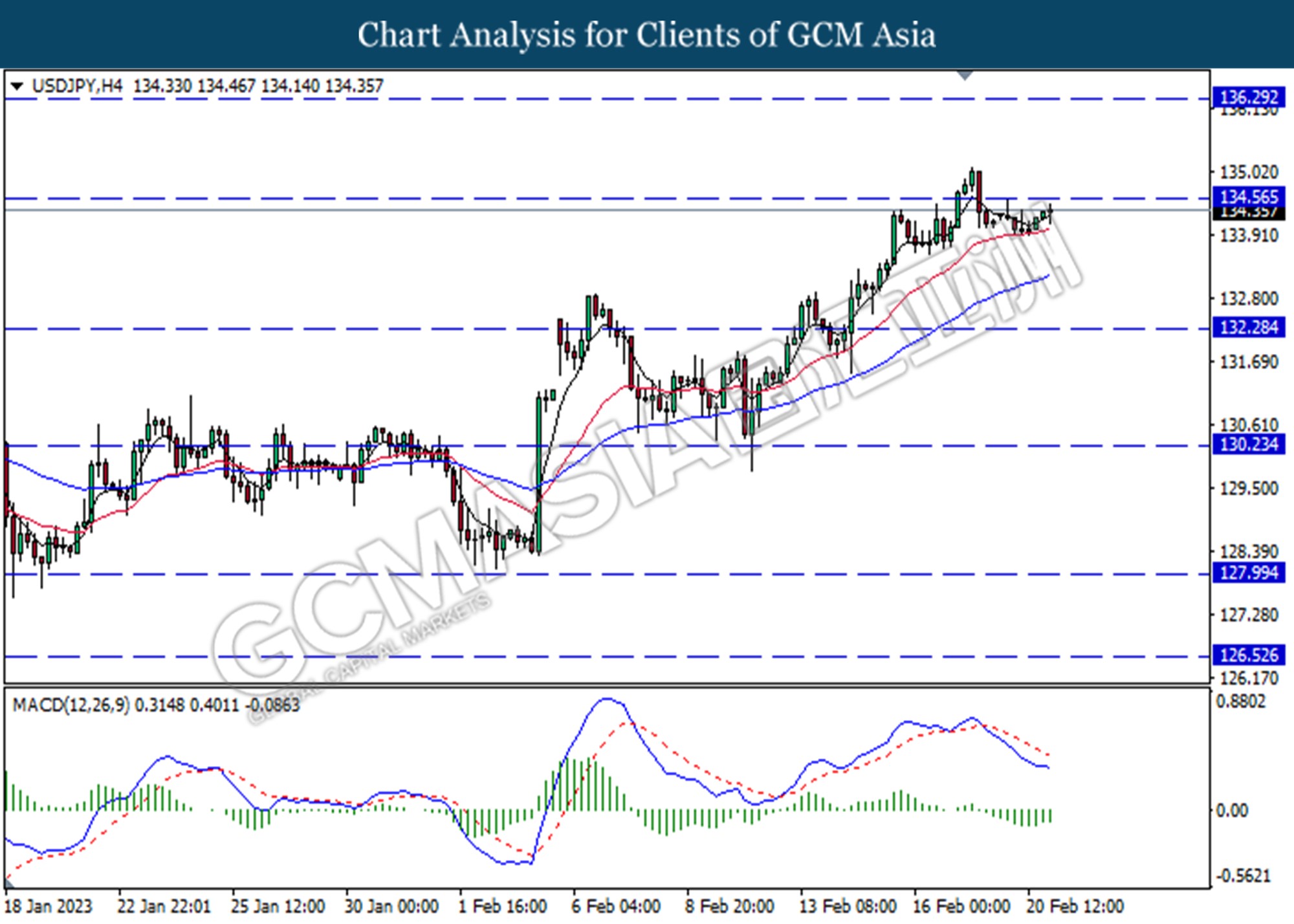

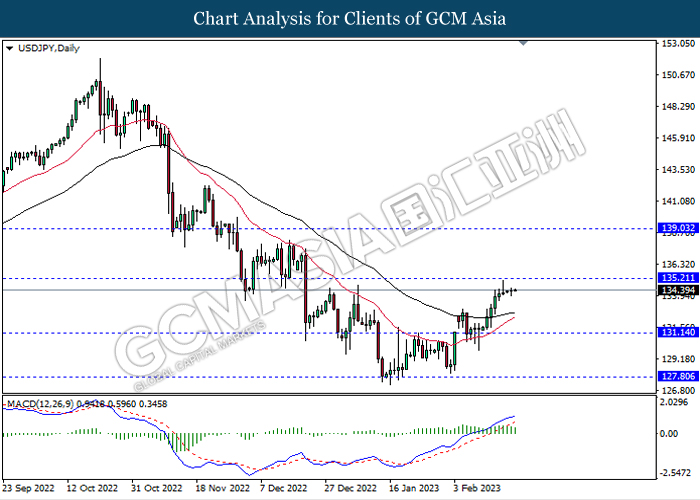

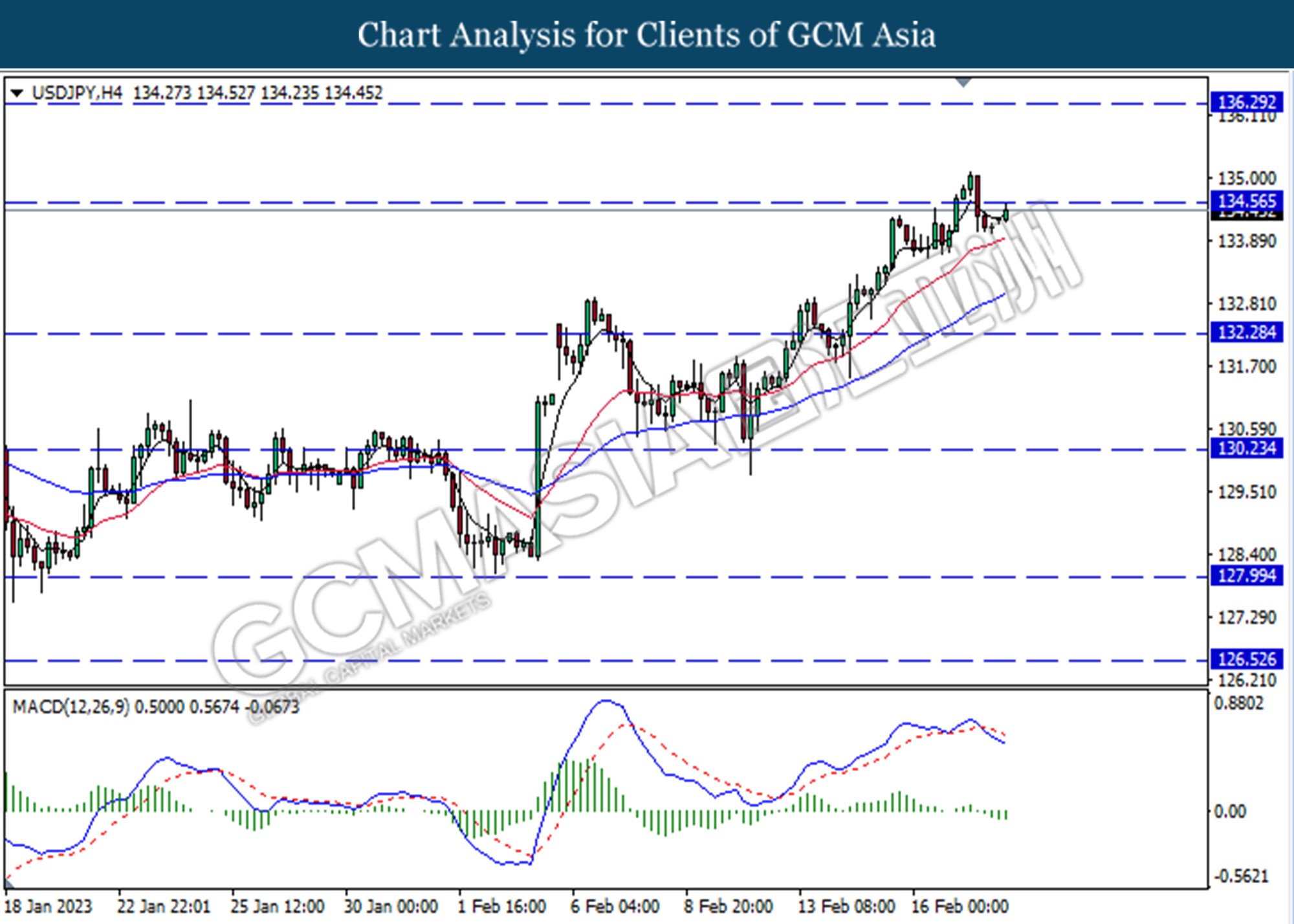

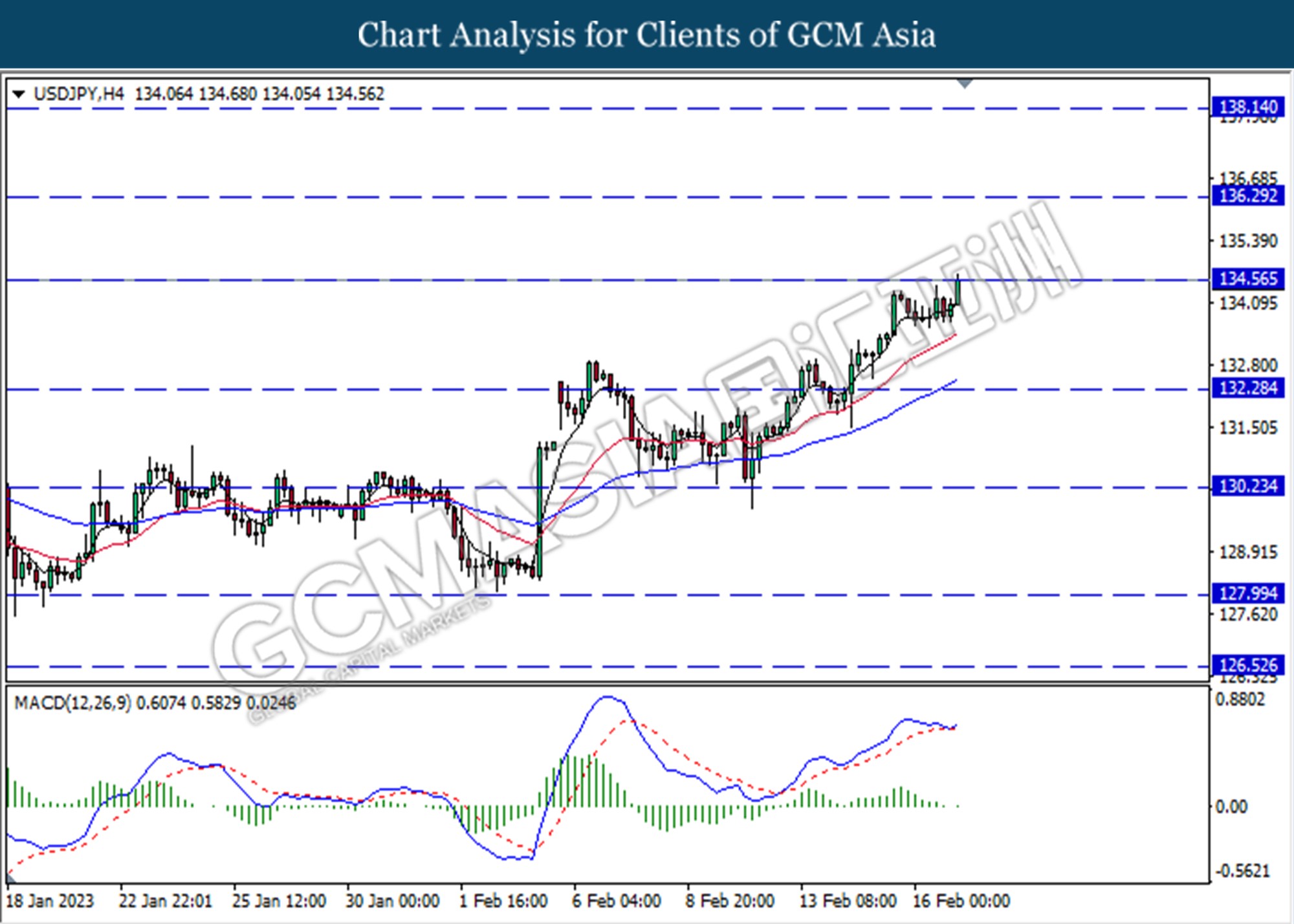

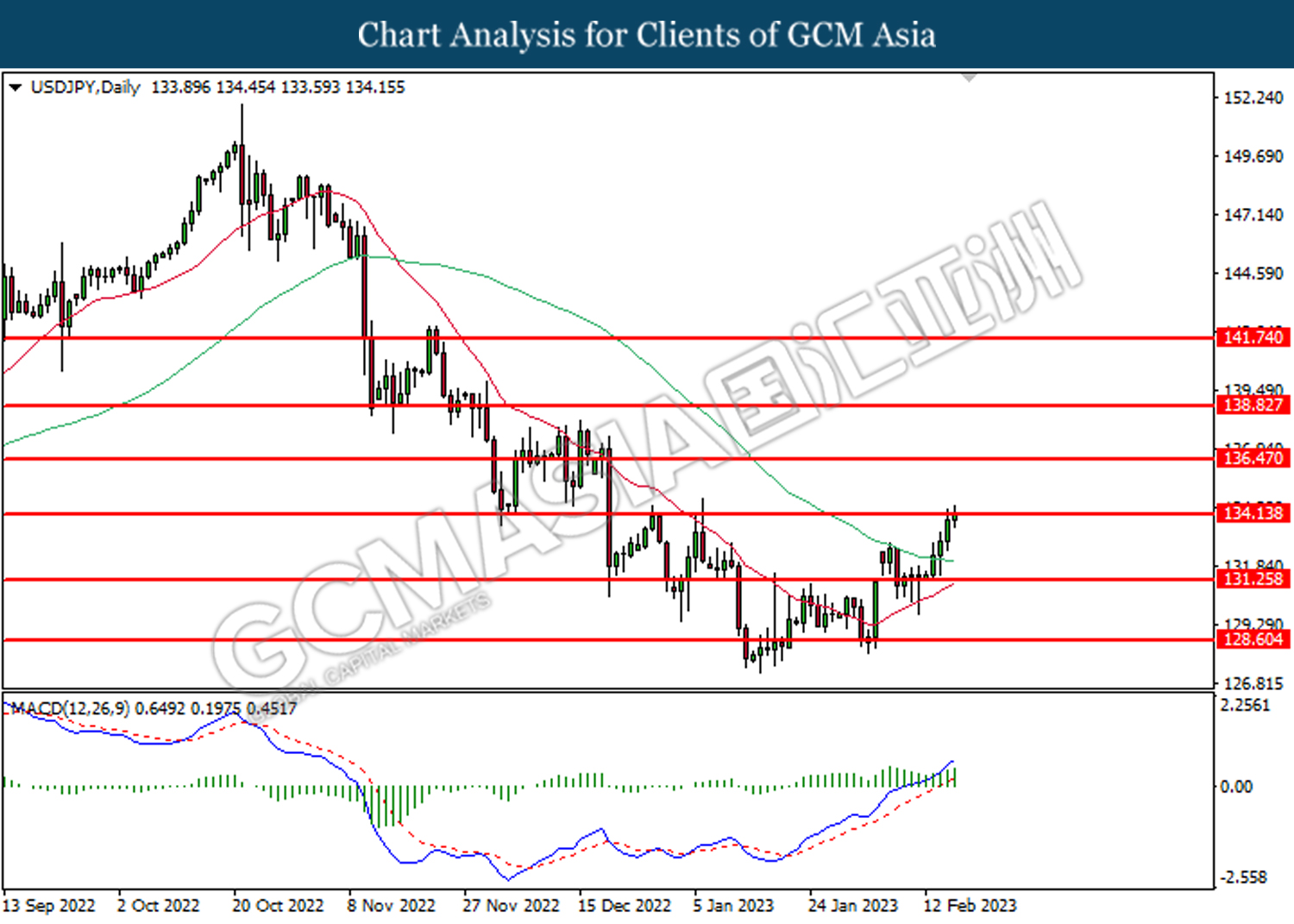

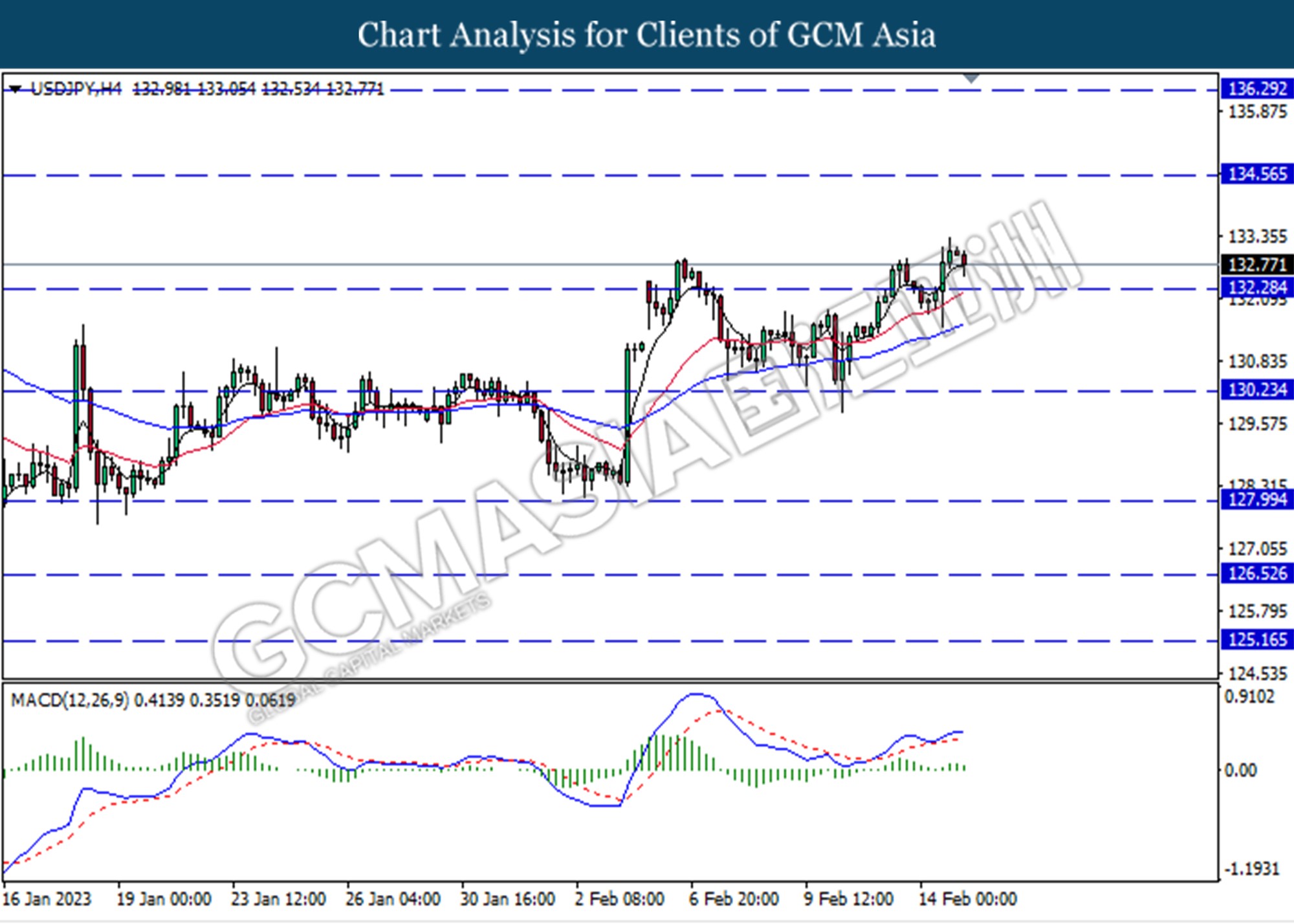

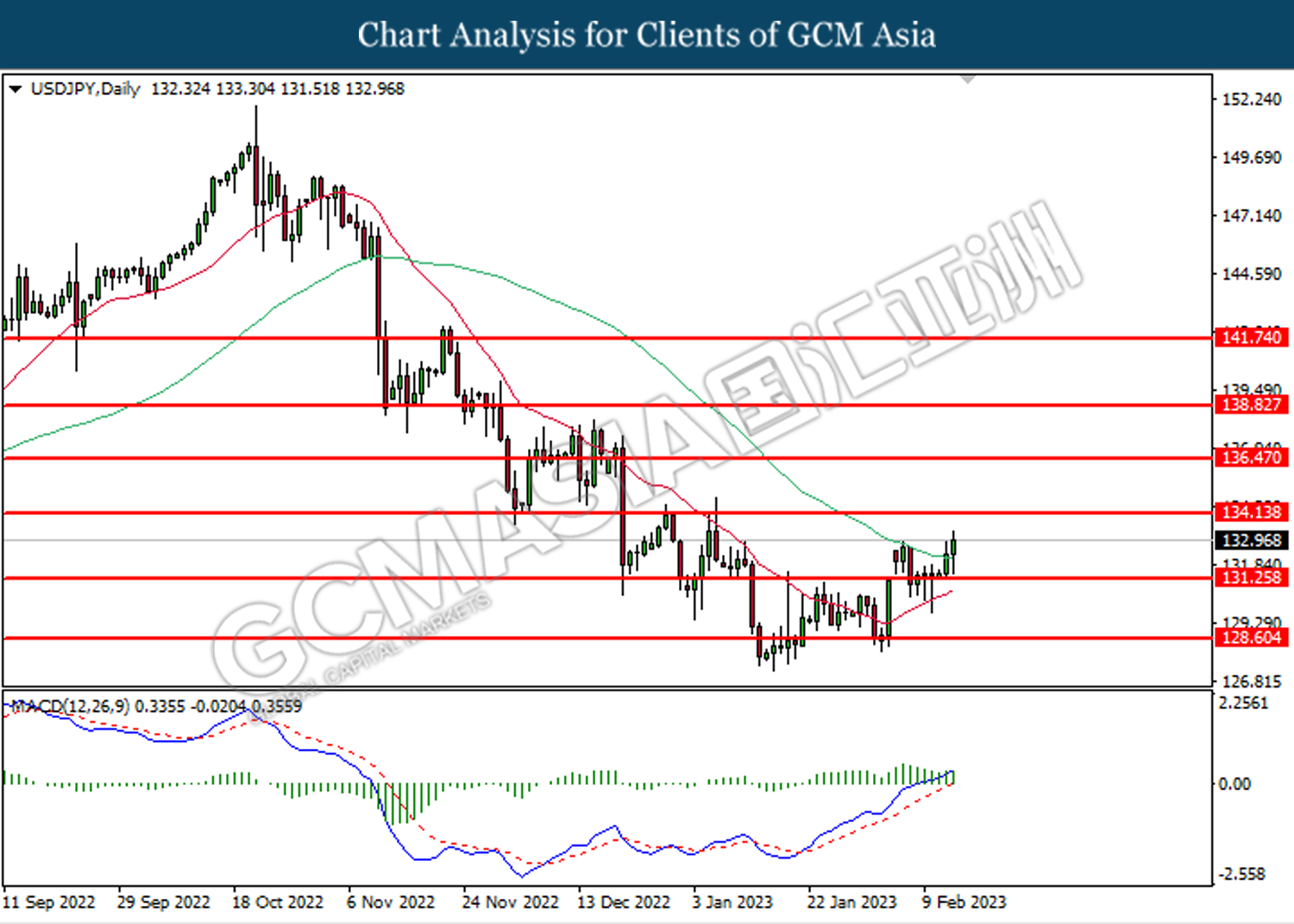

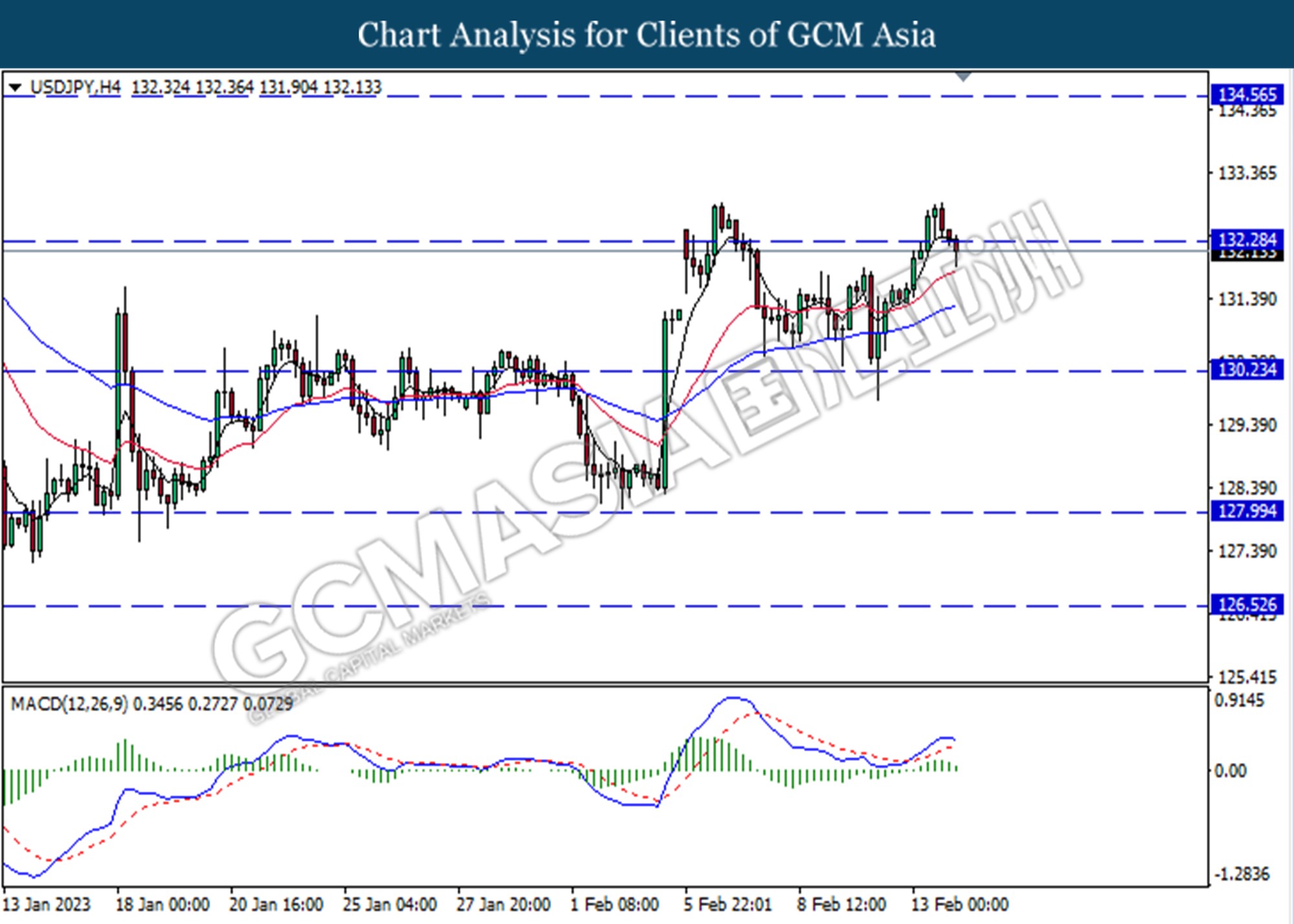

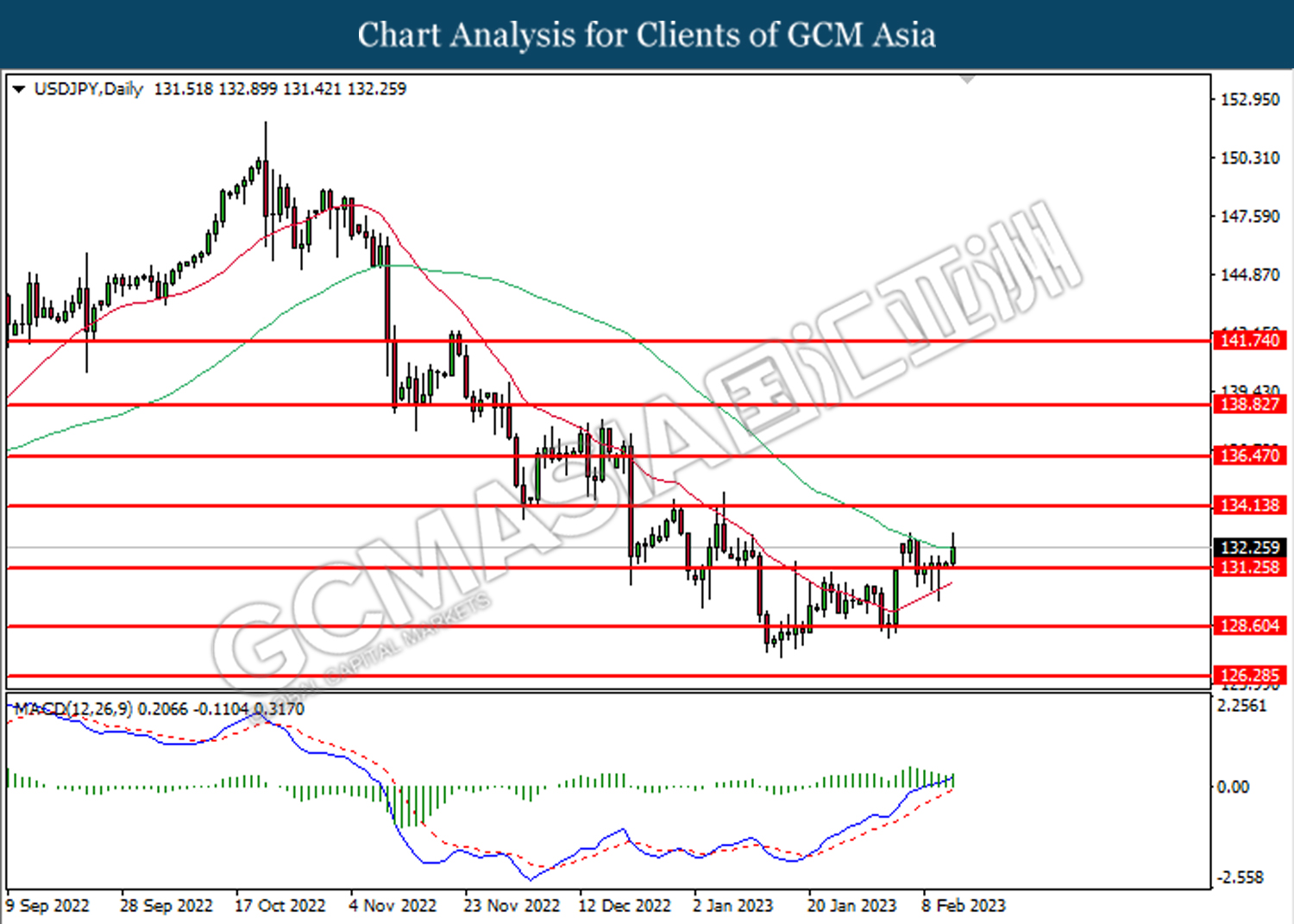

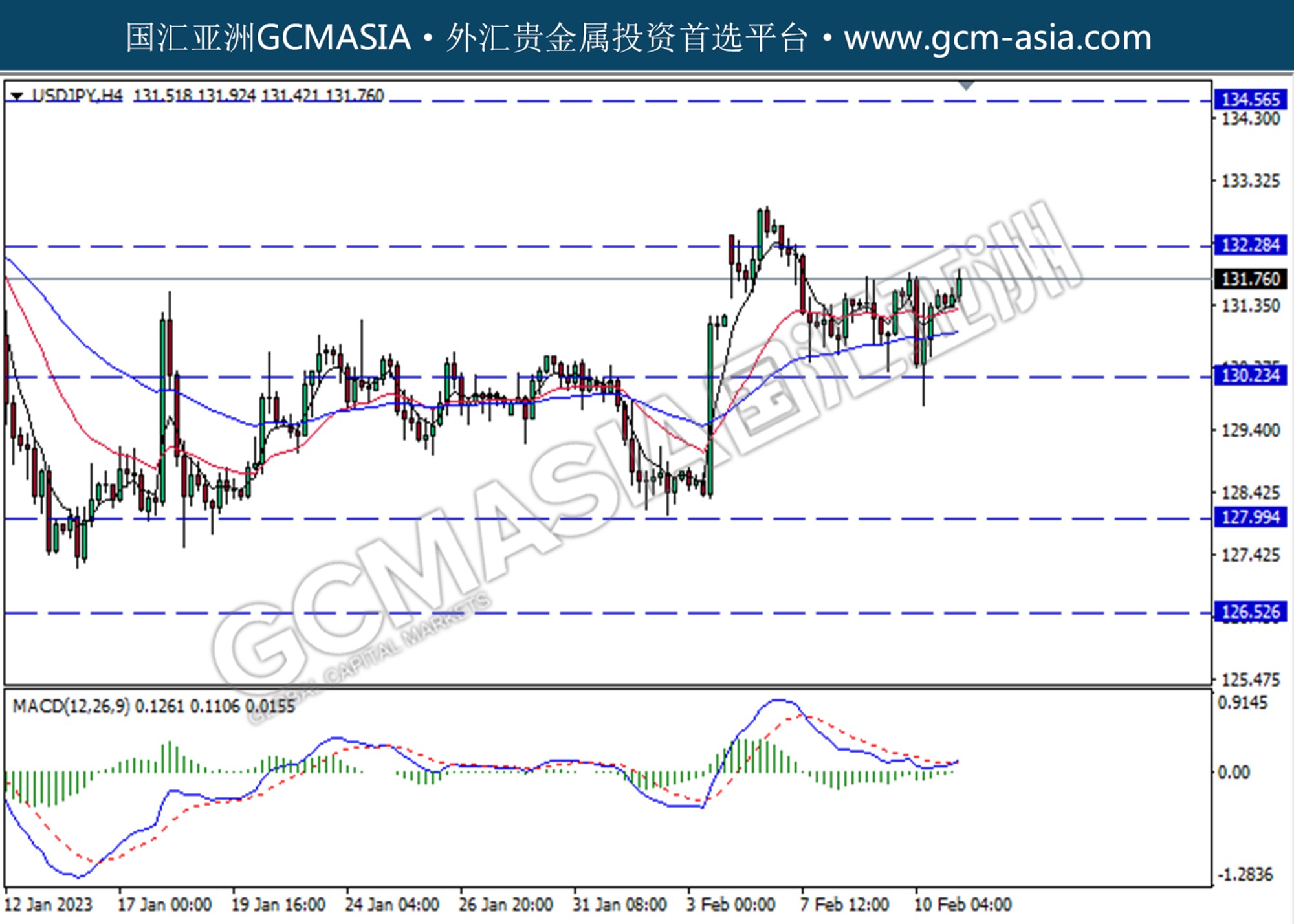

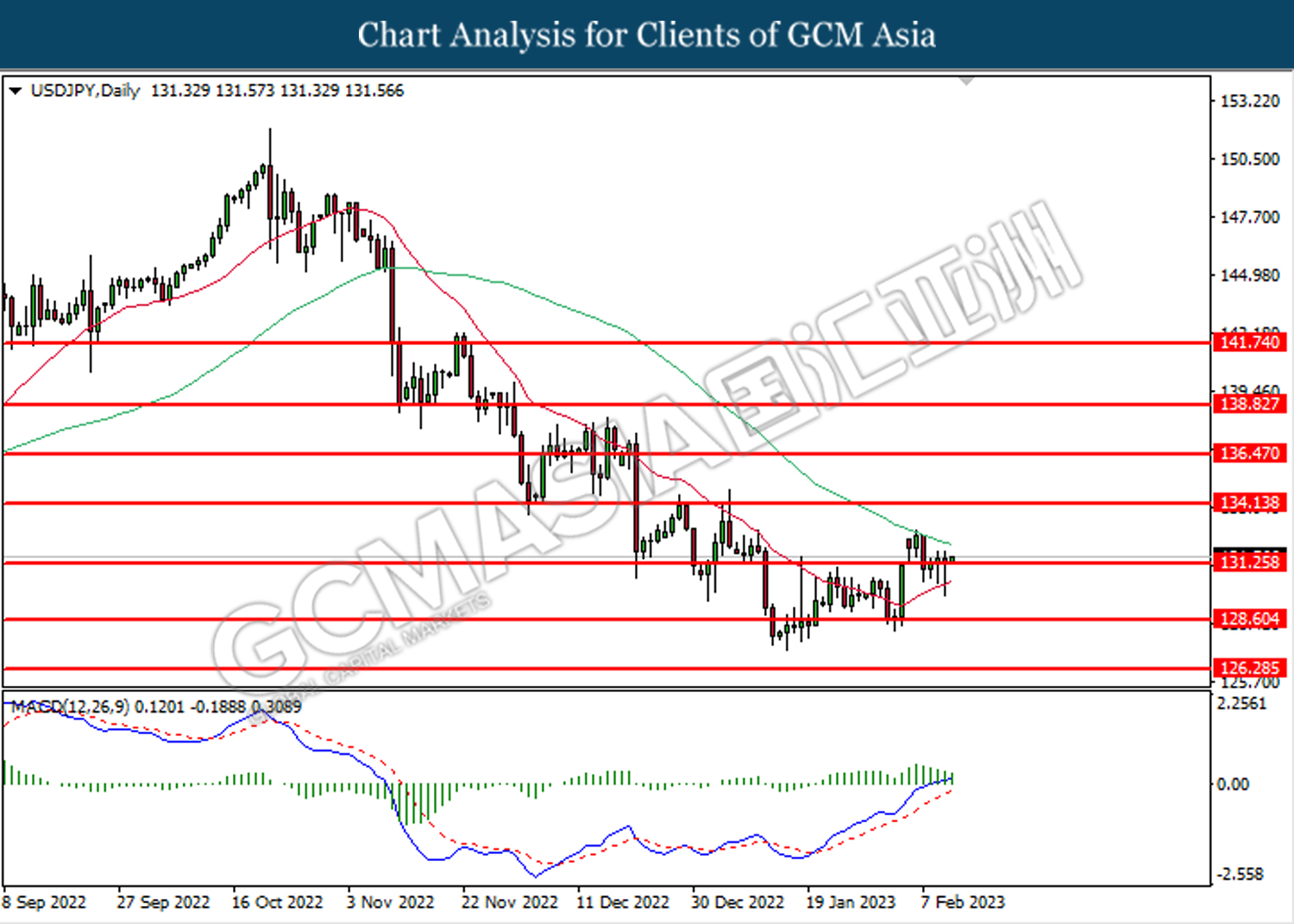

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lowest level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

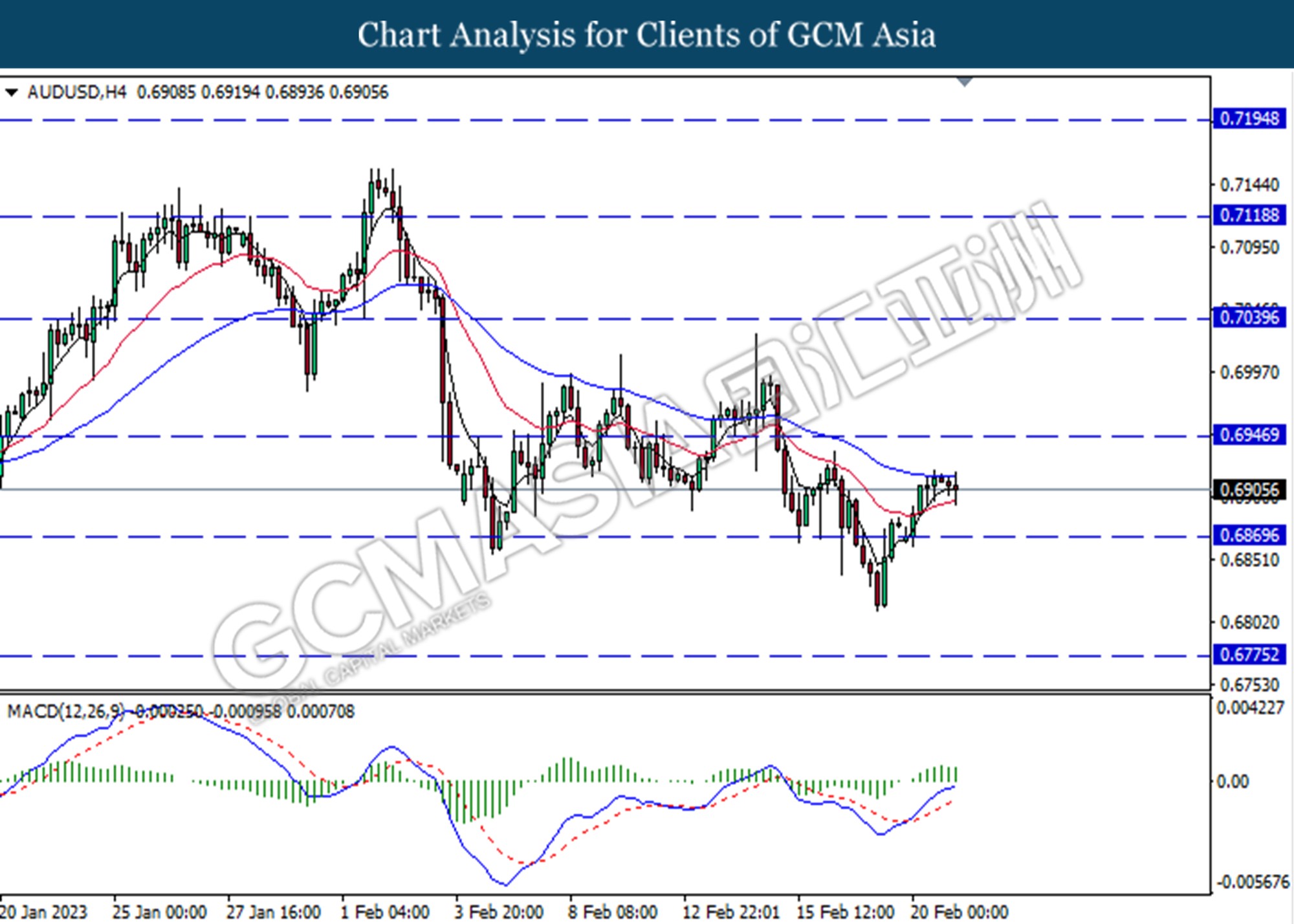

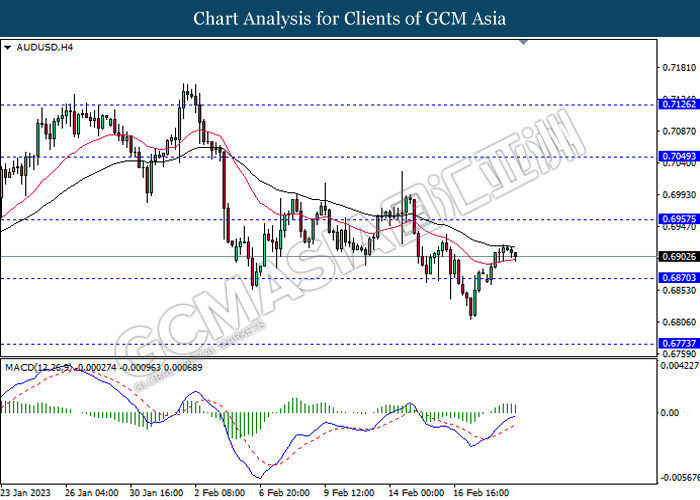

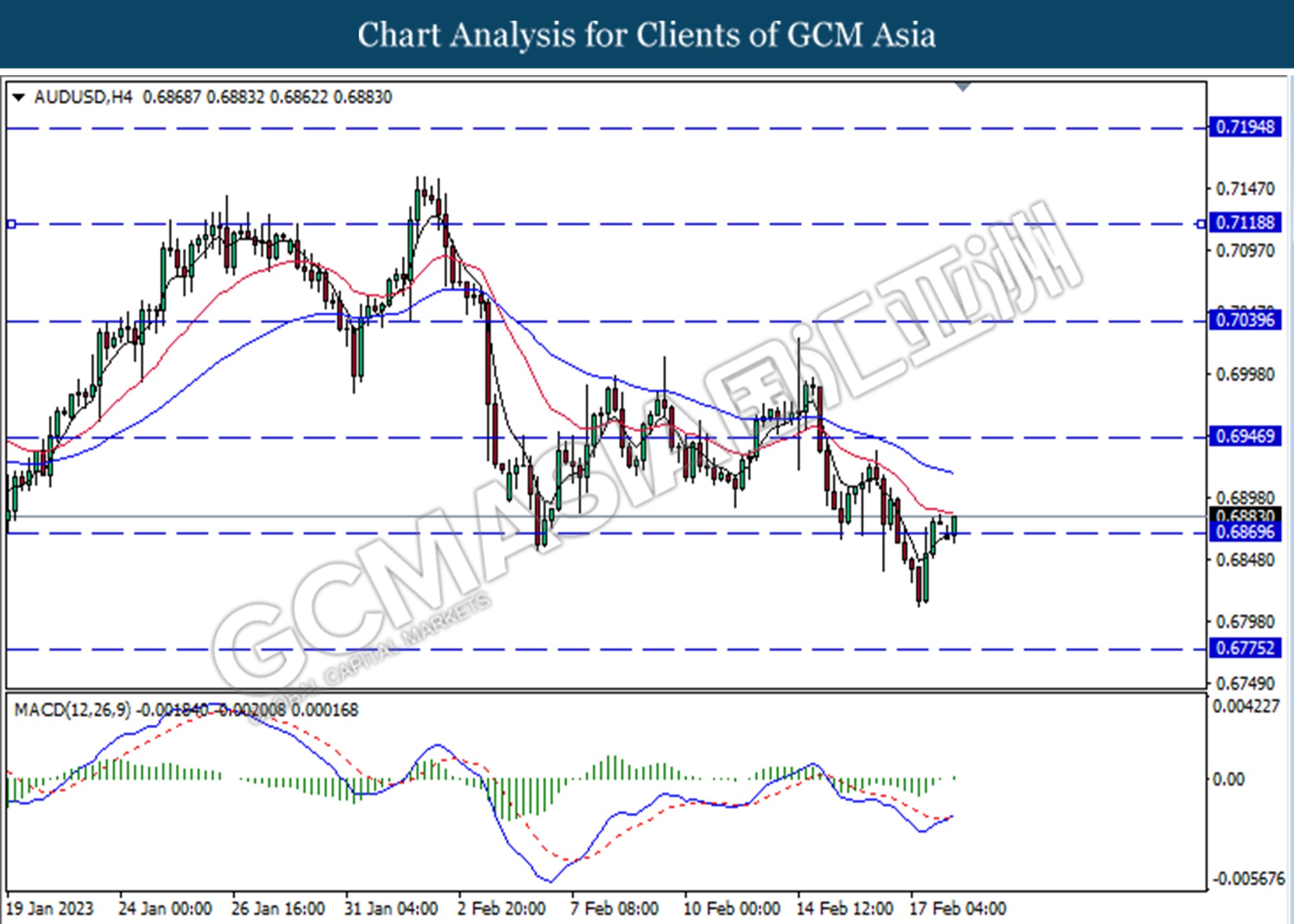

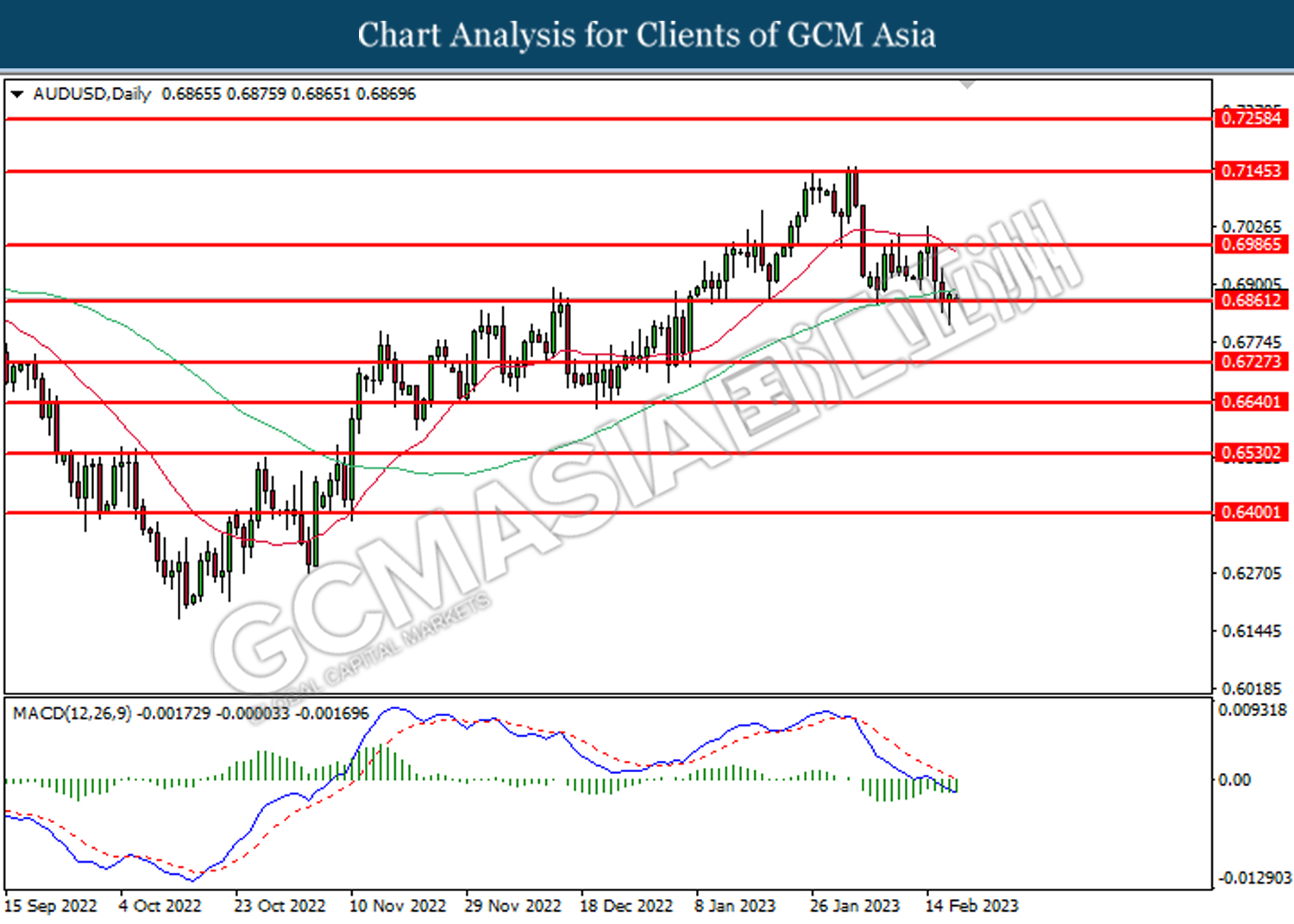

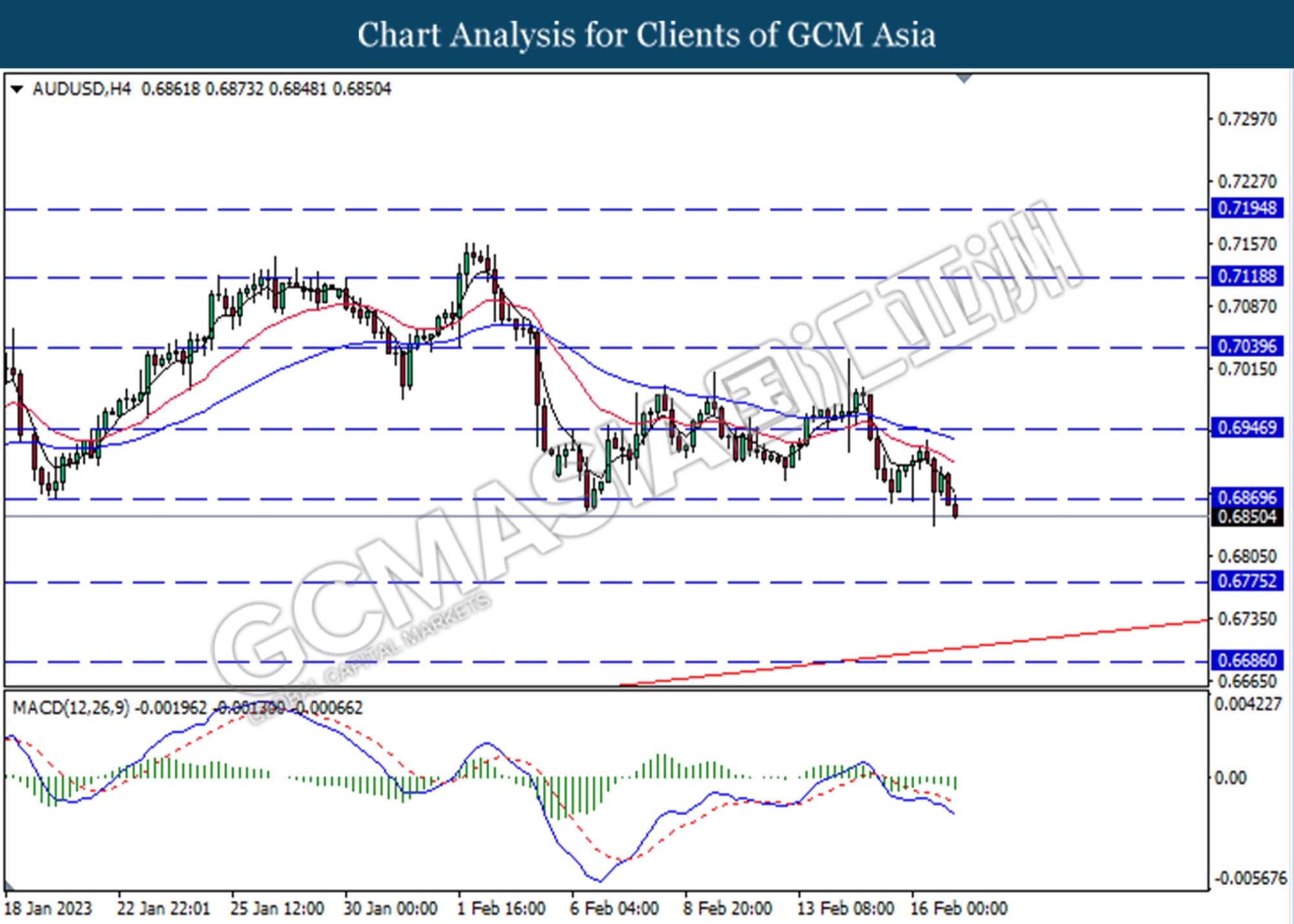

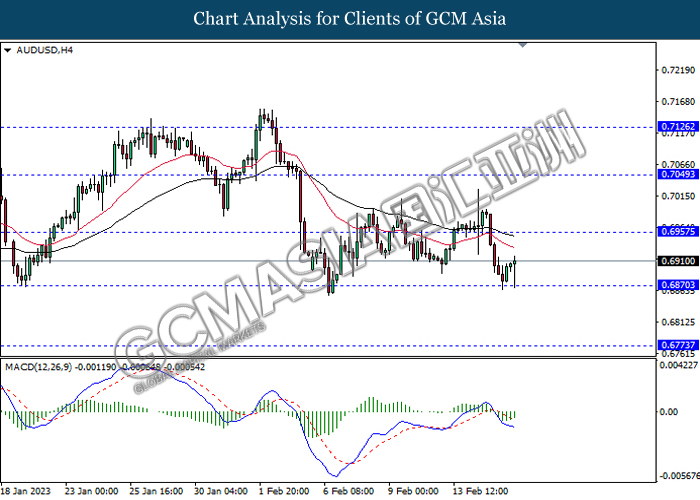

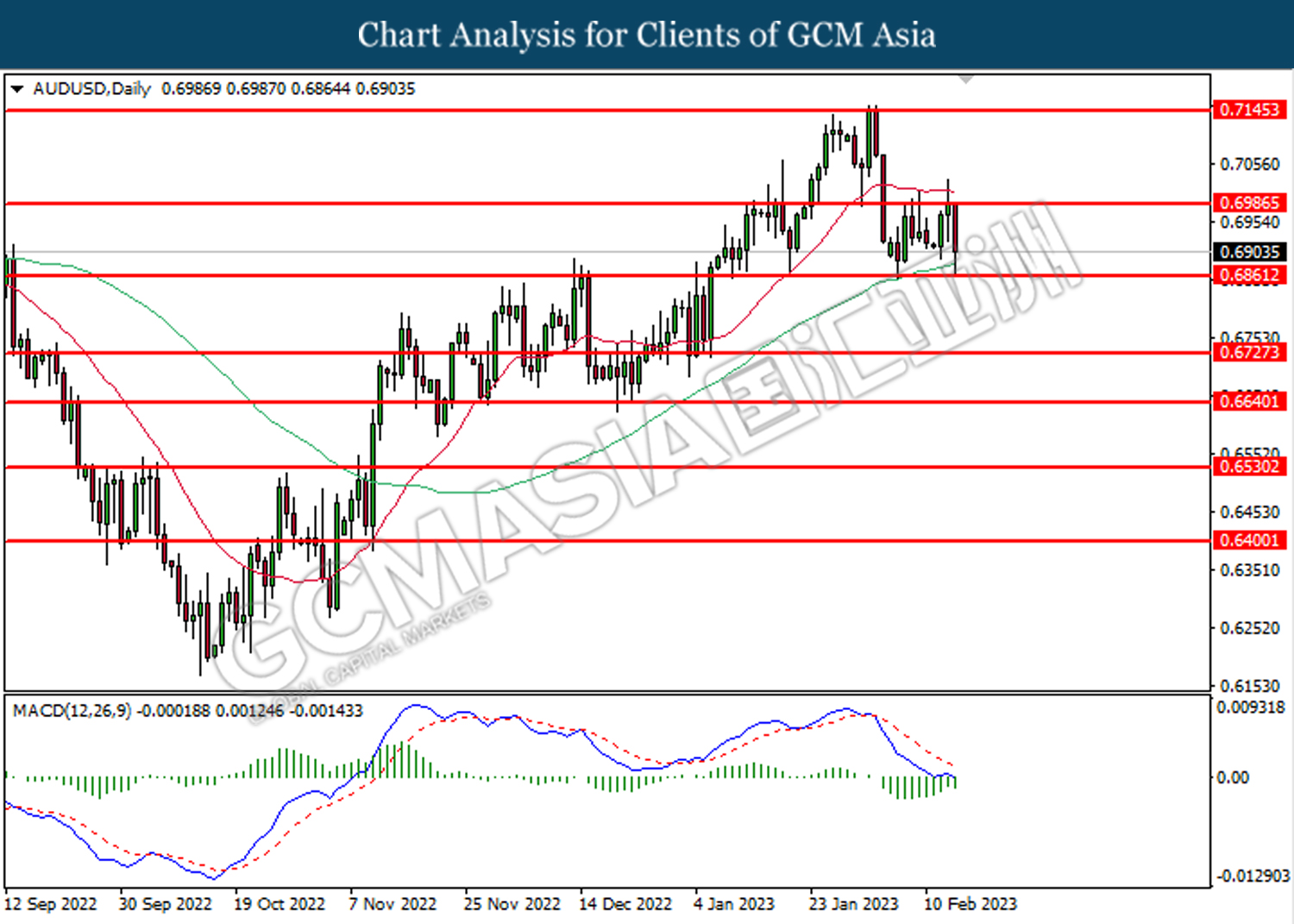

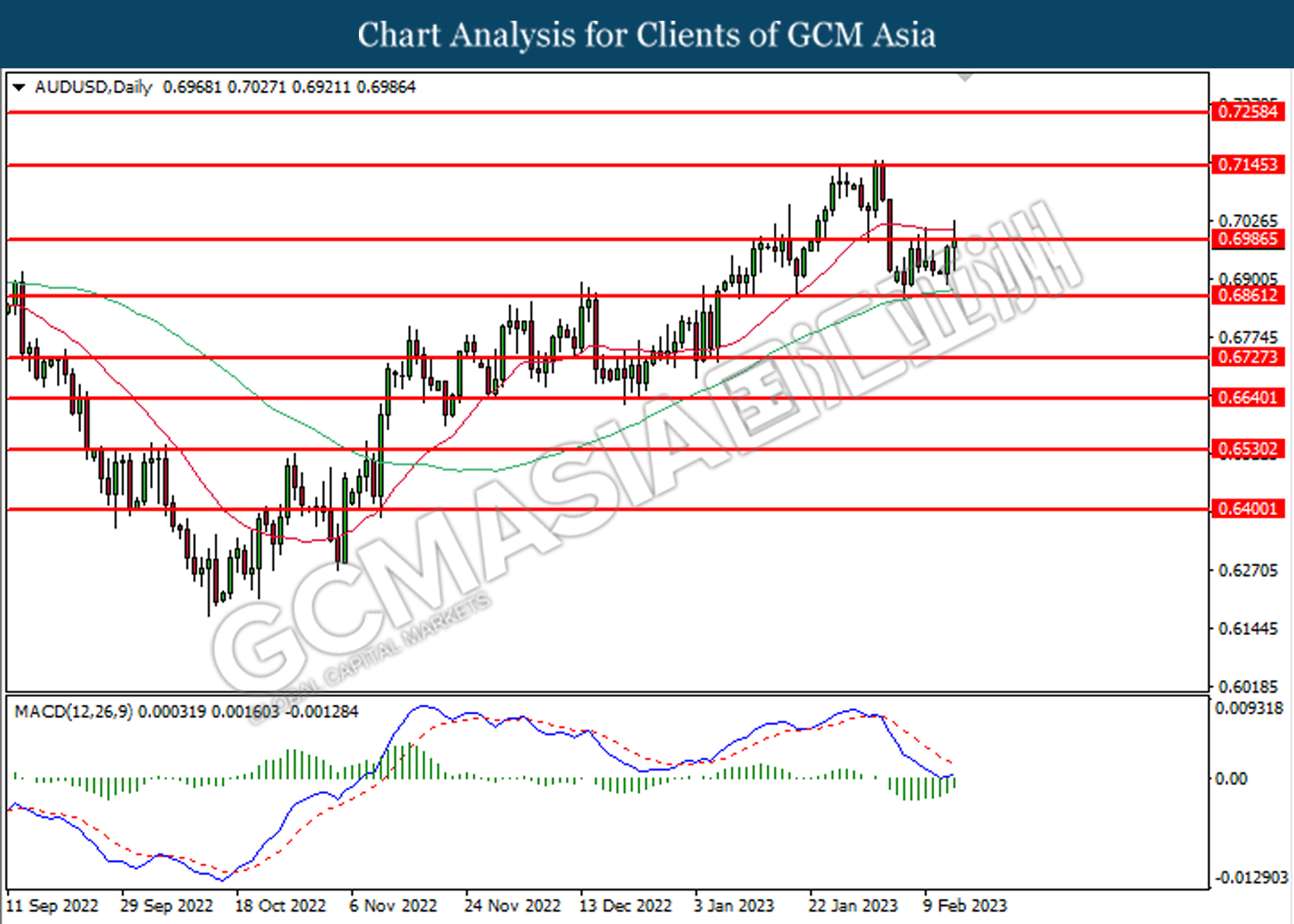

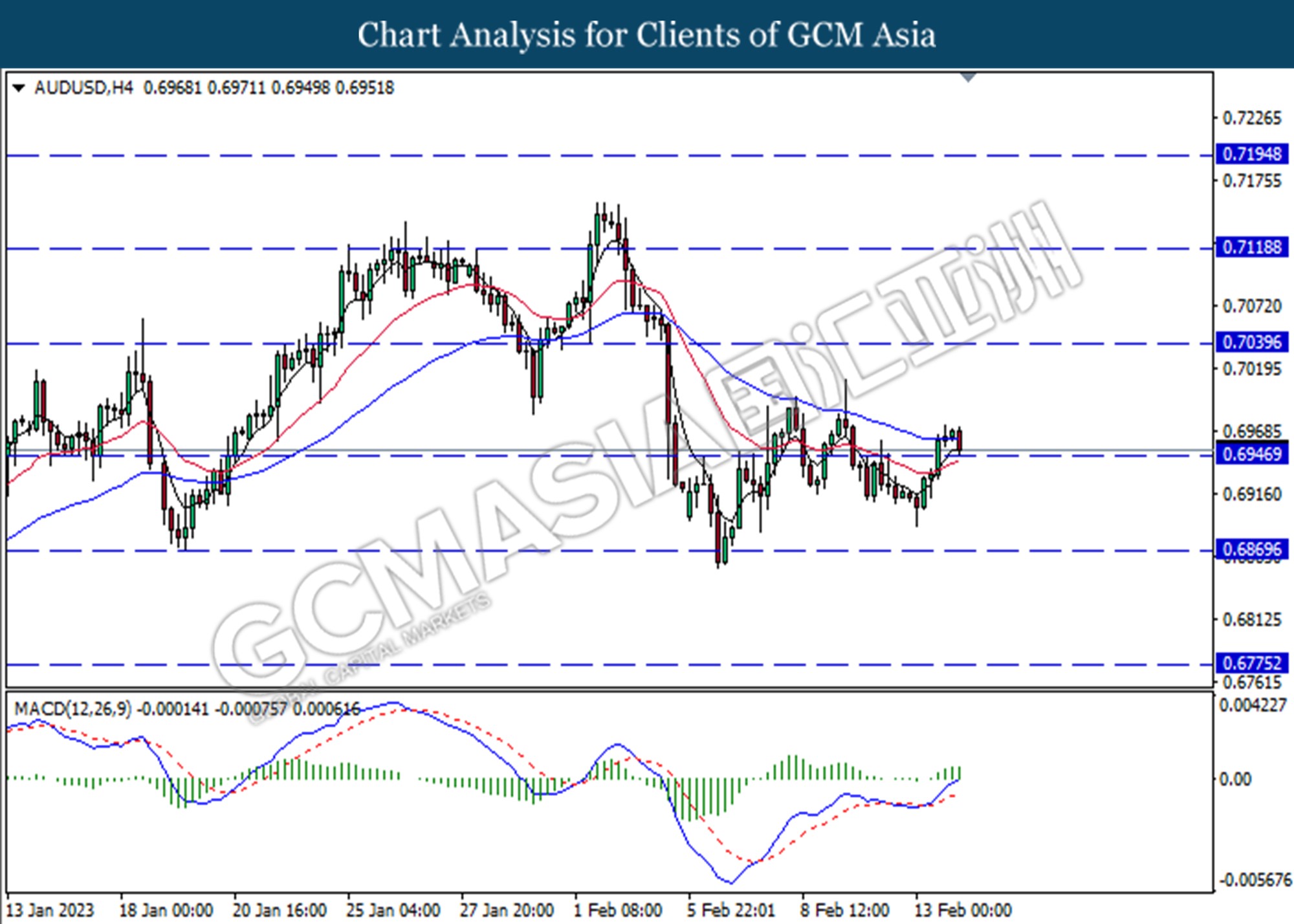

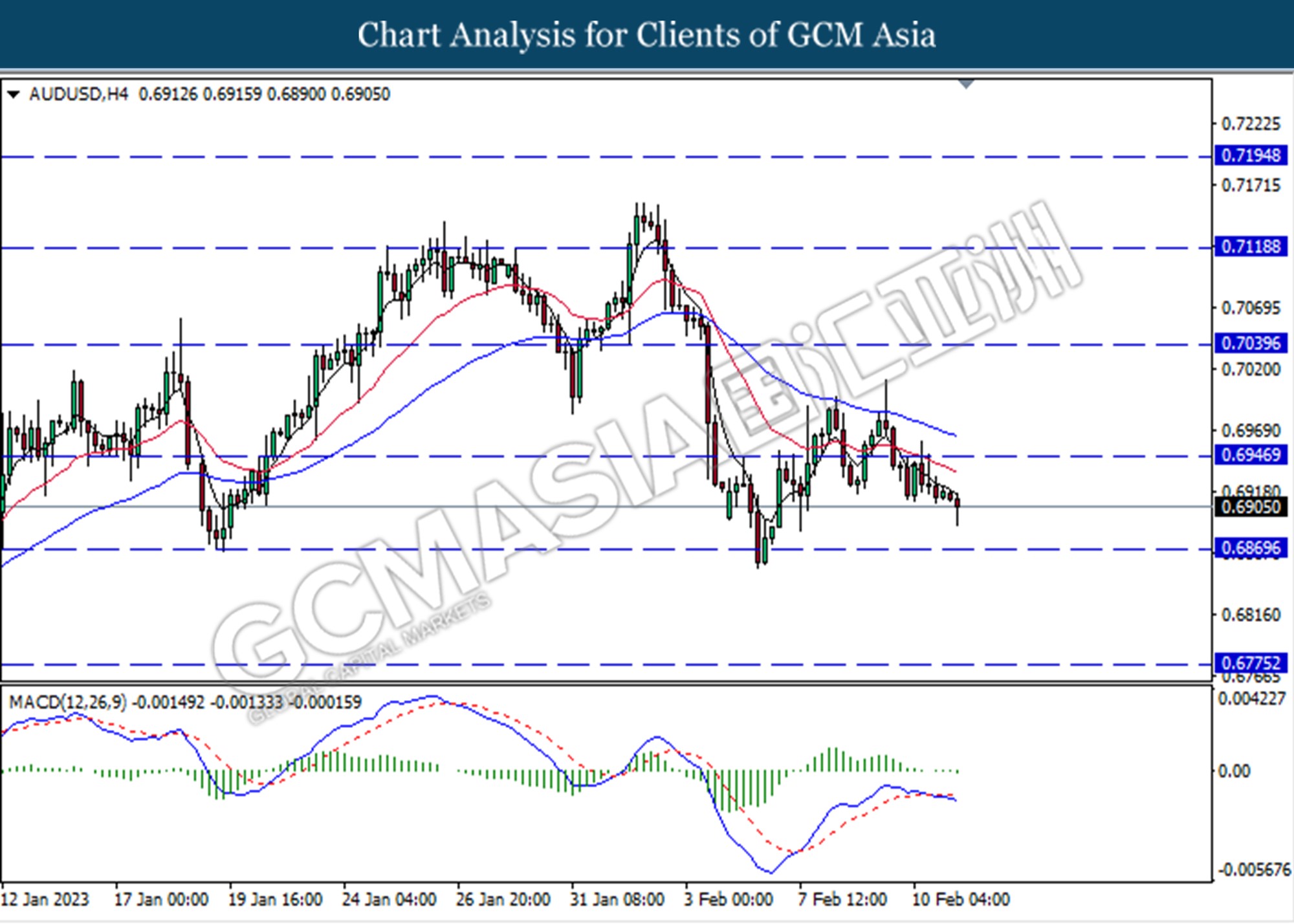

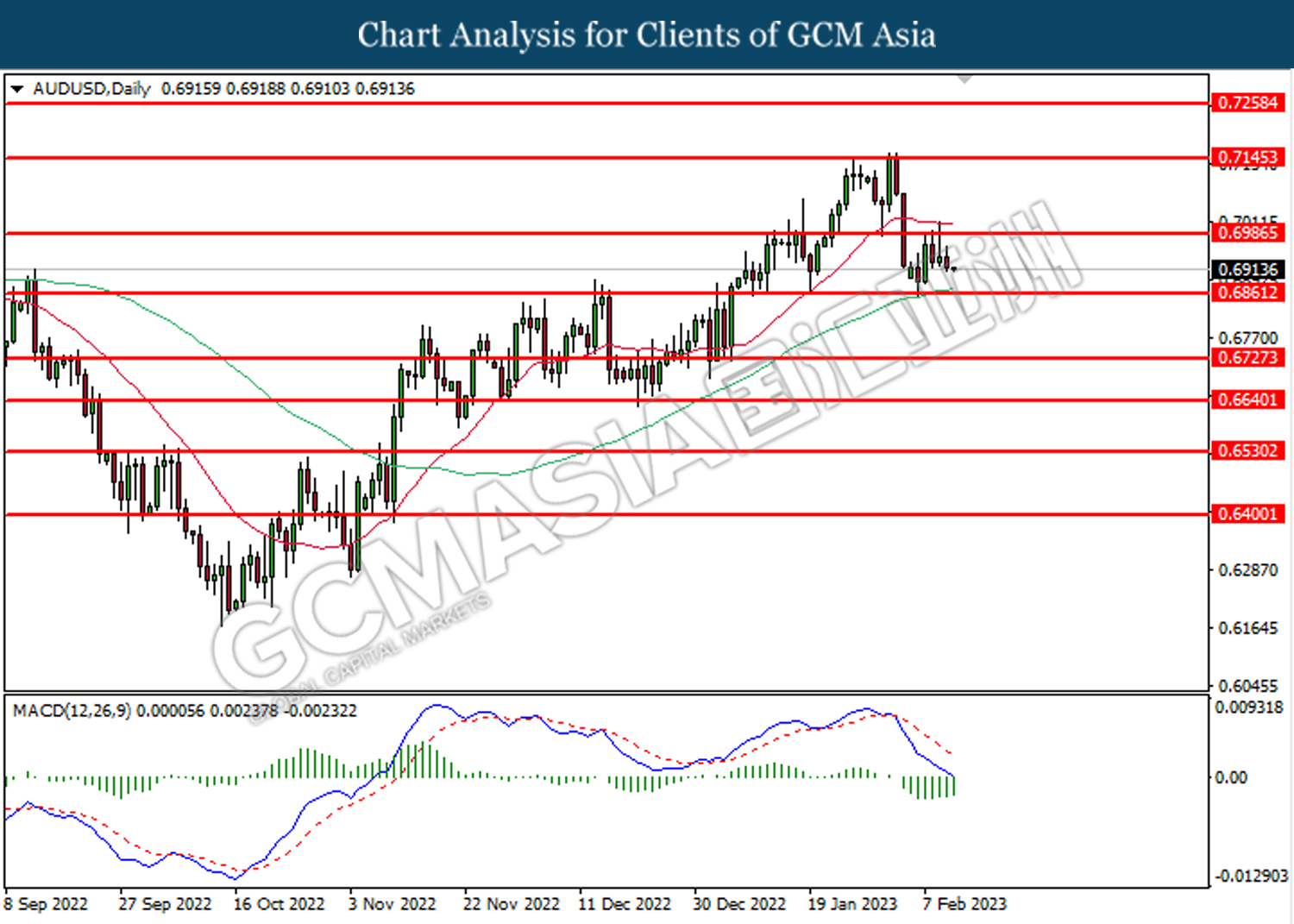

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from a higher level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6870.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

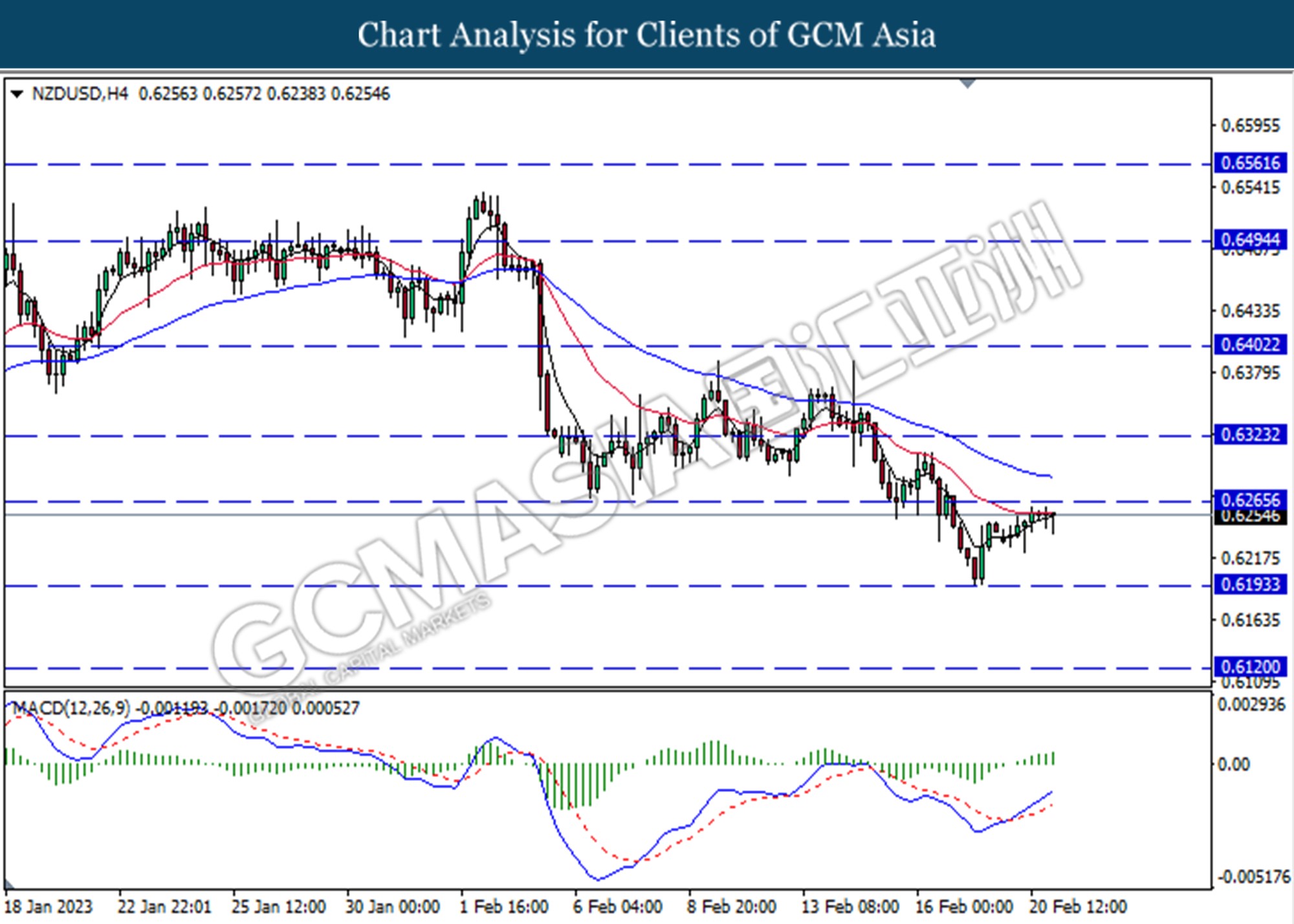

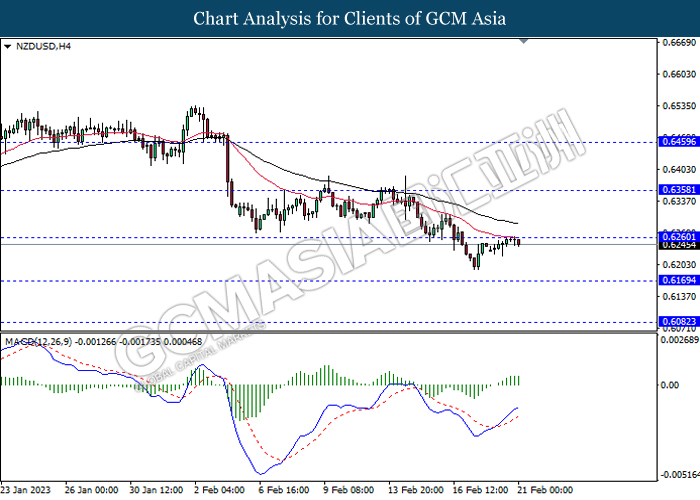

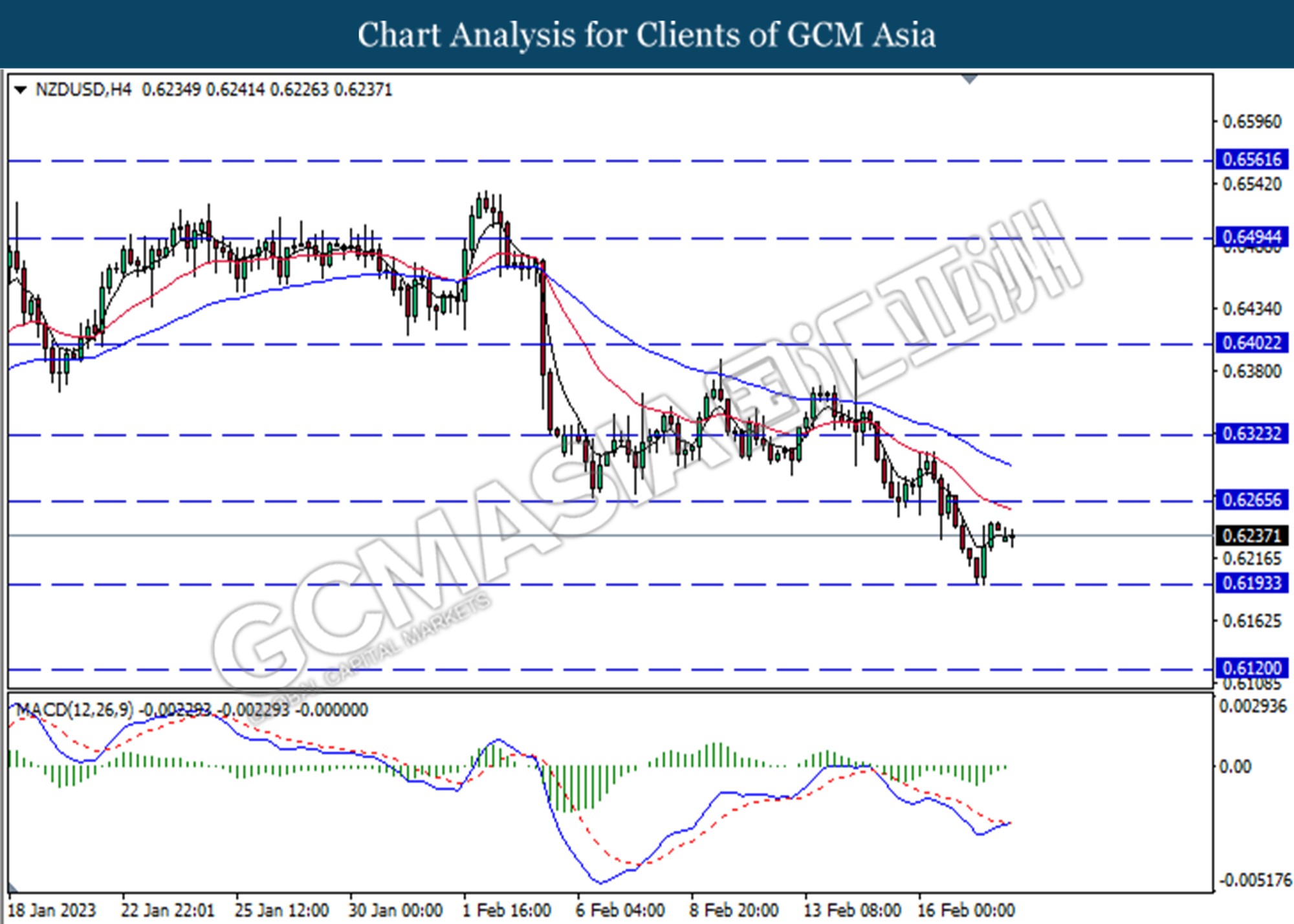

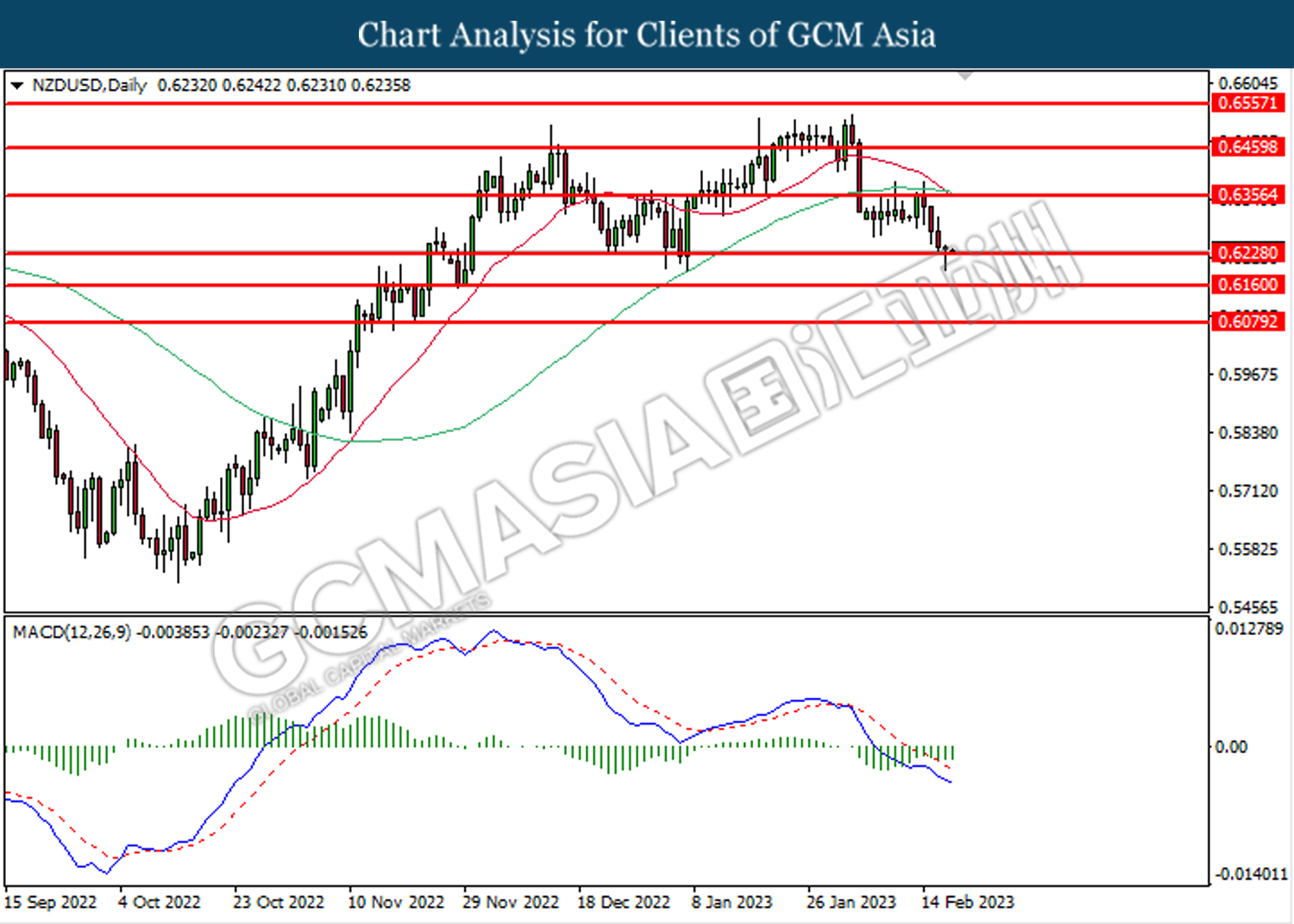

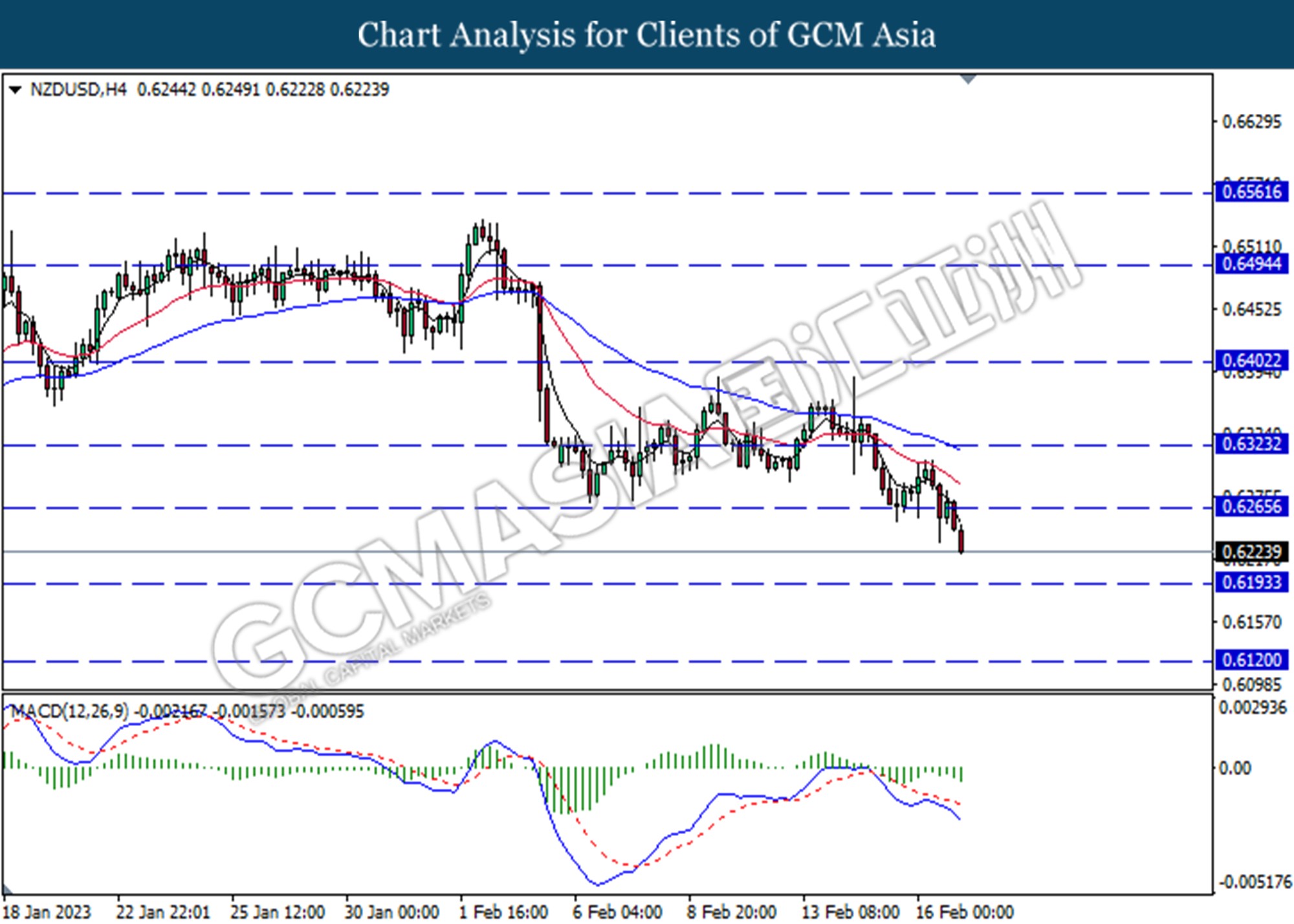

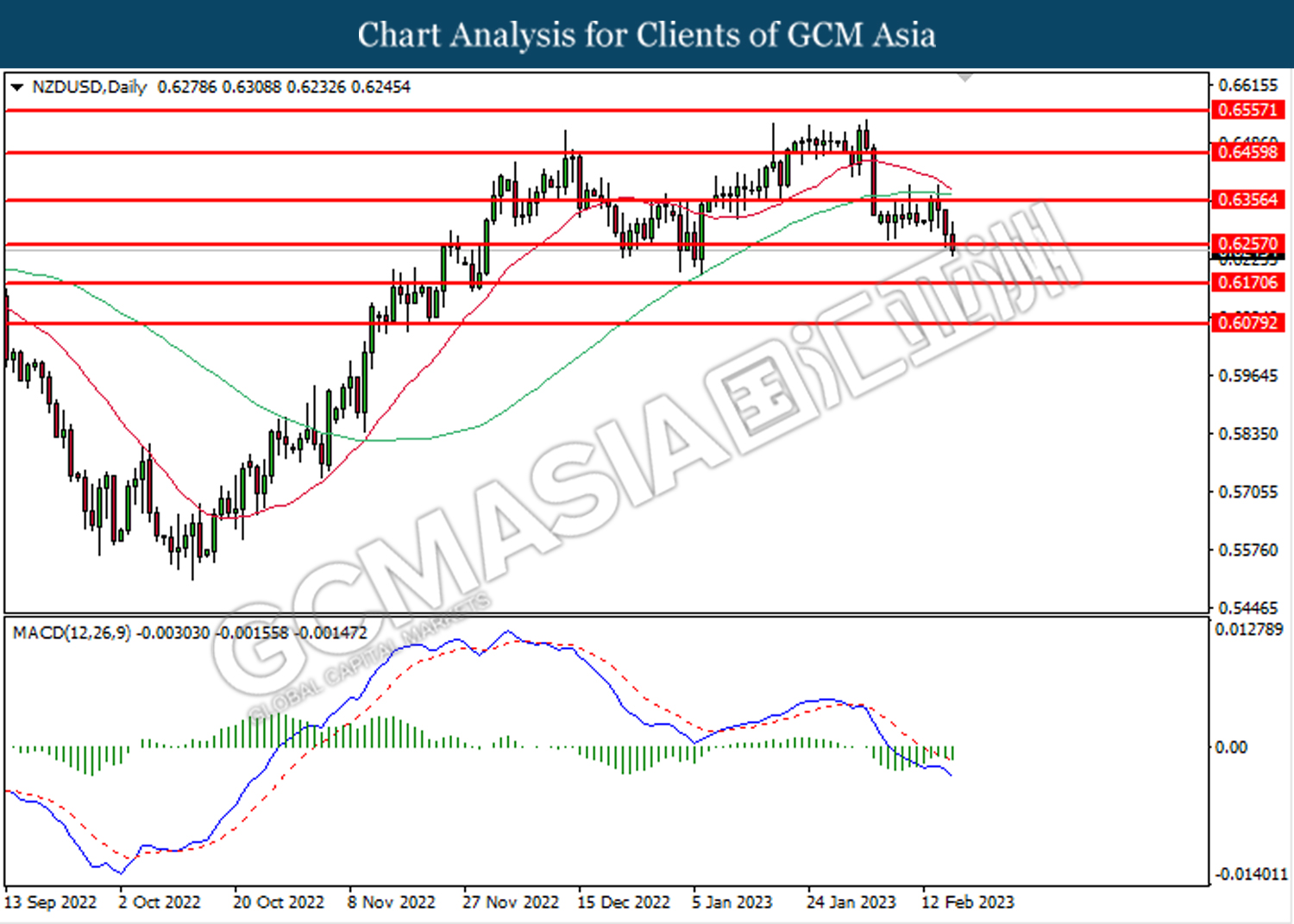

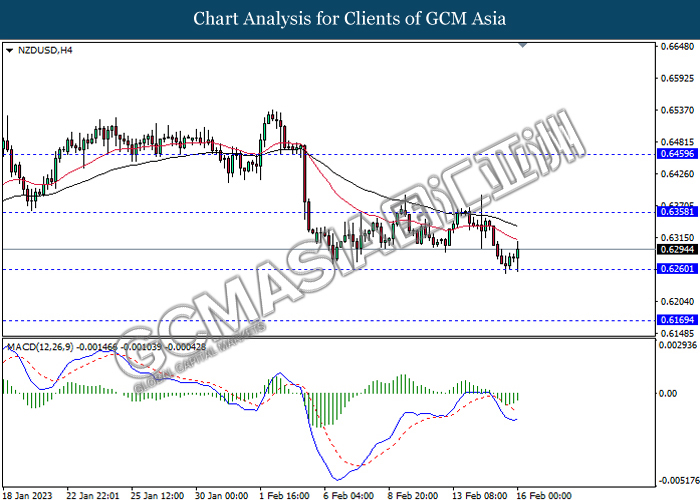

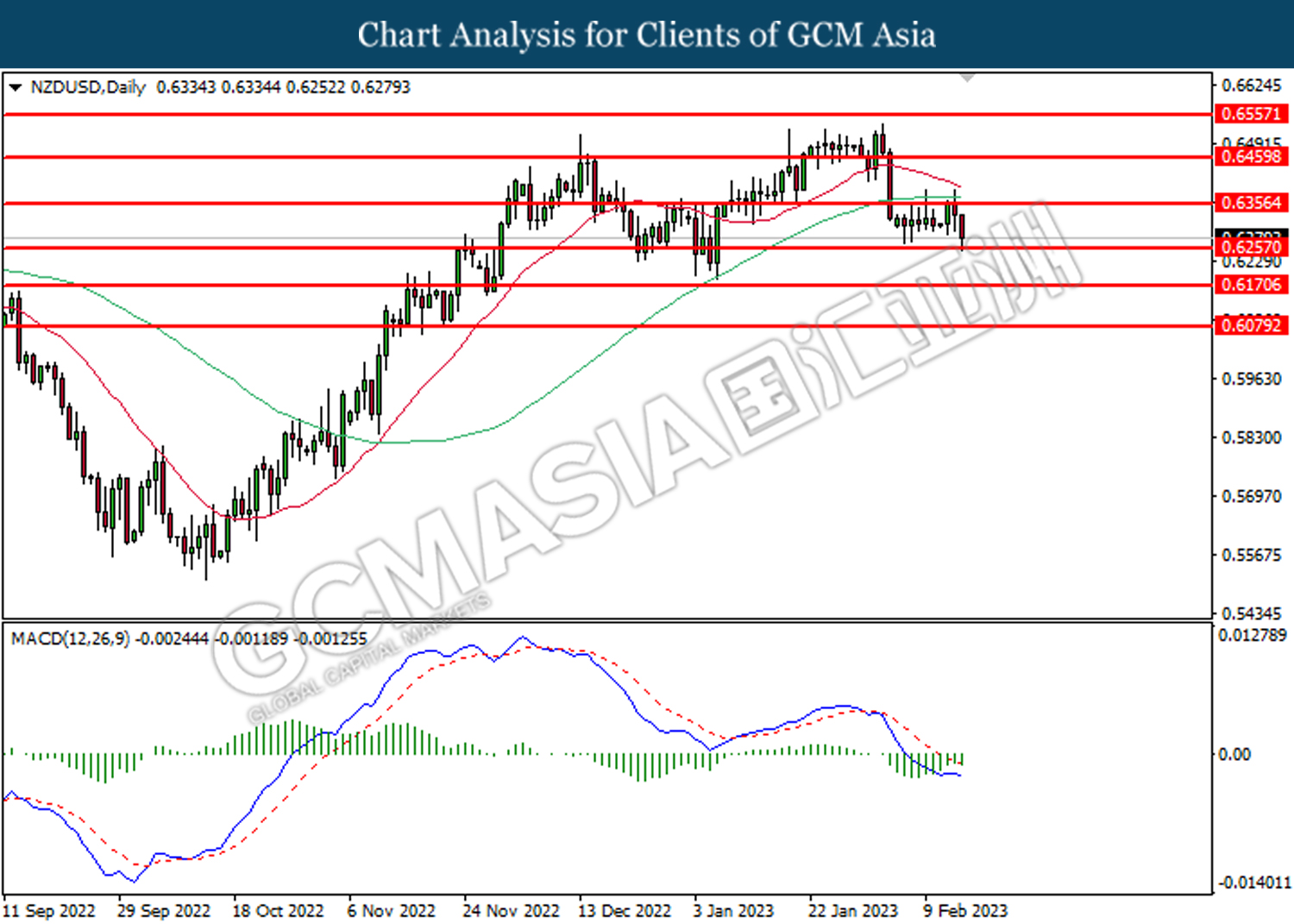

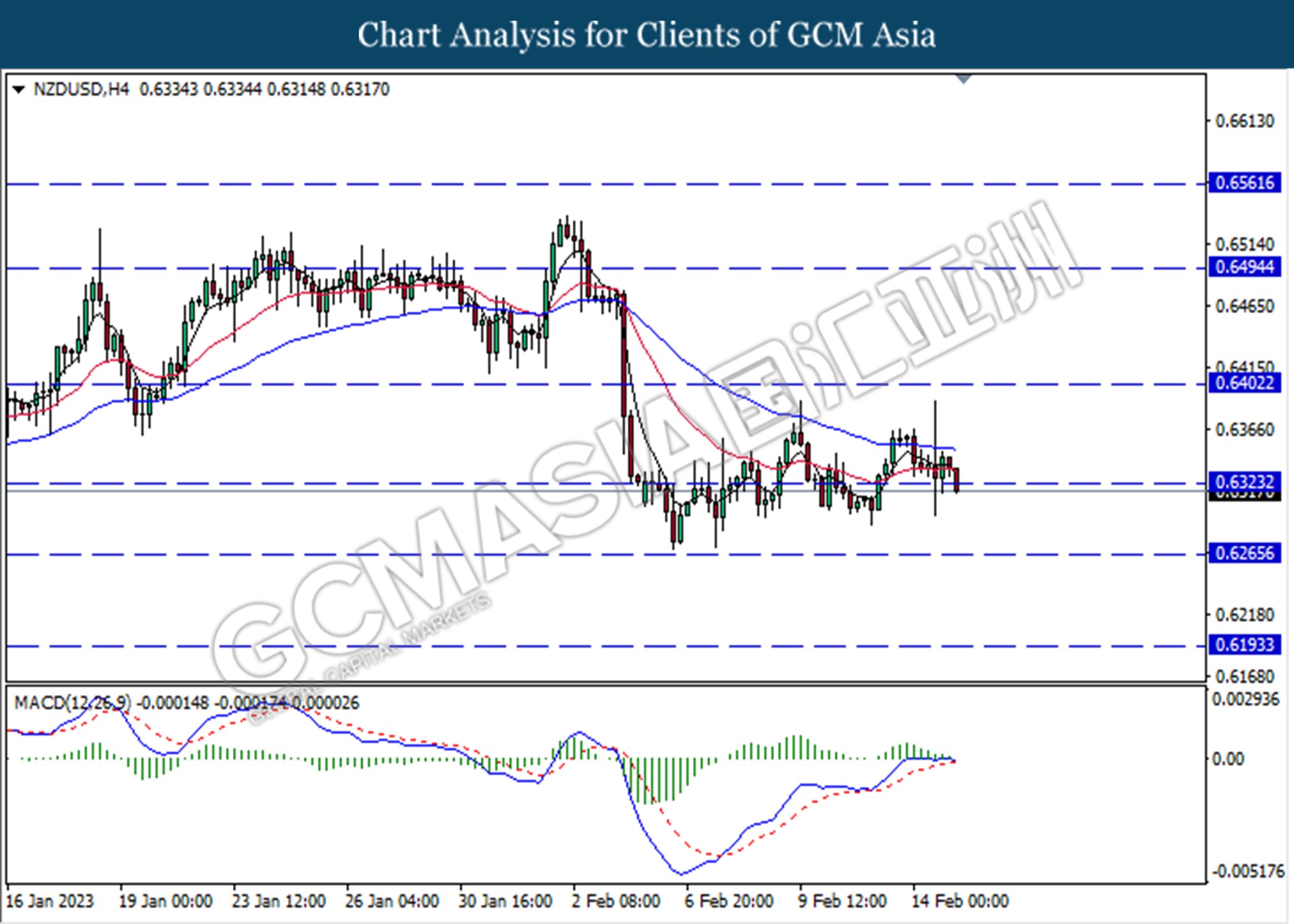

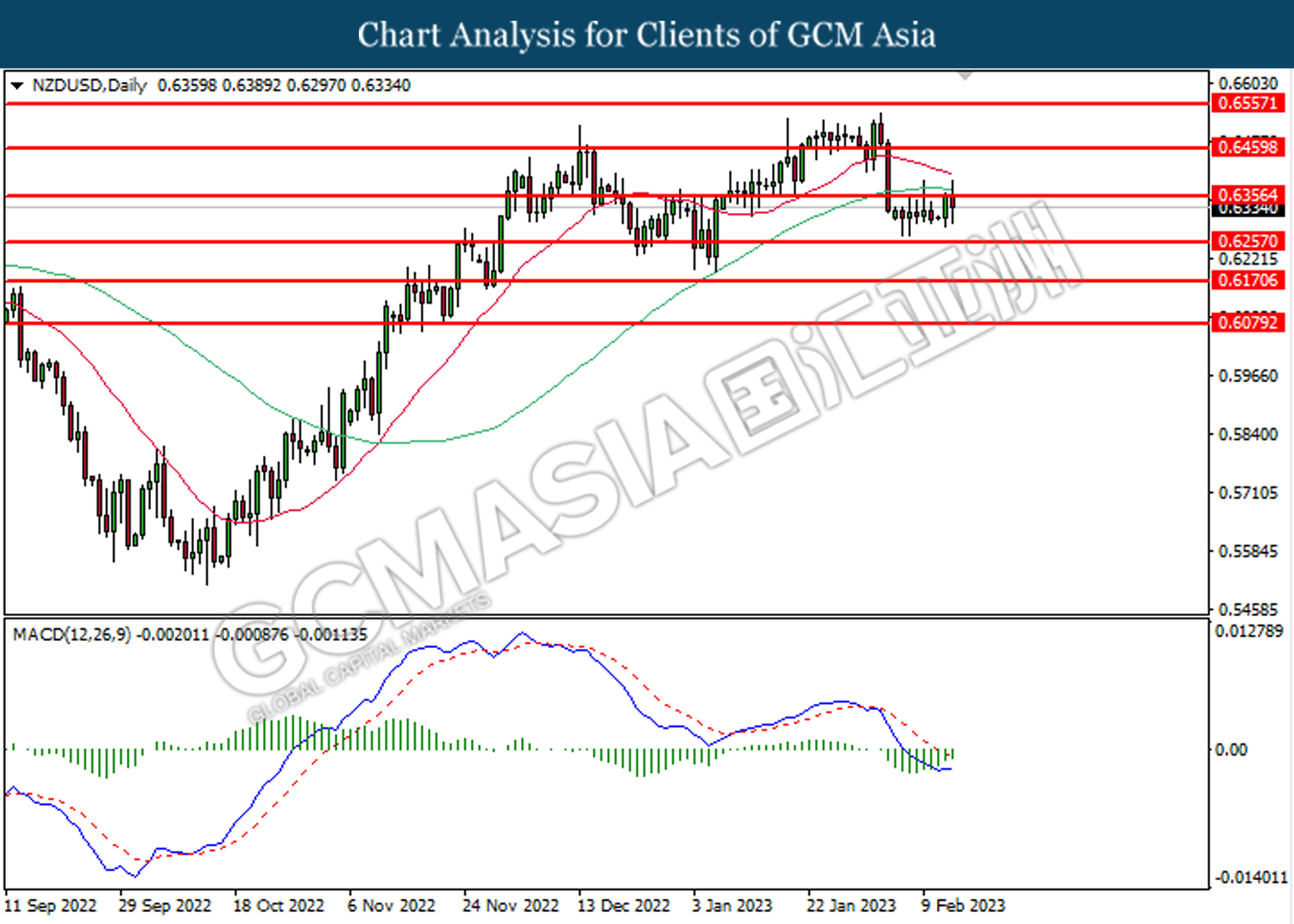

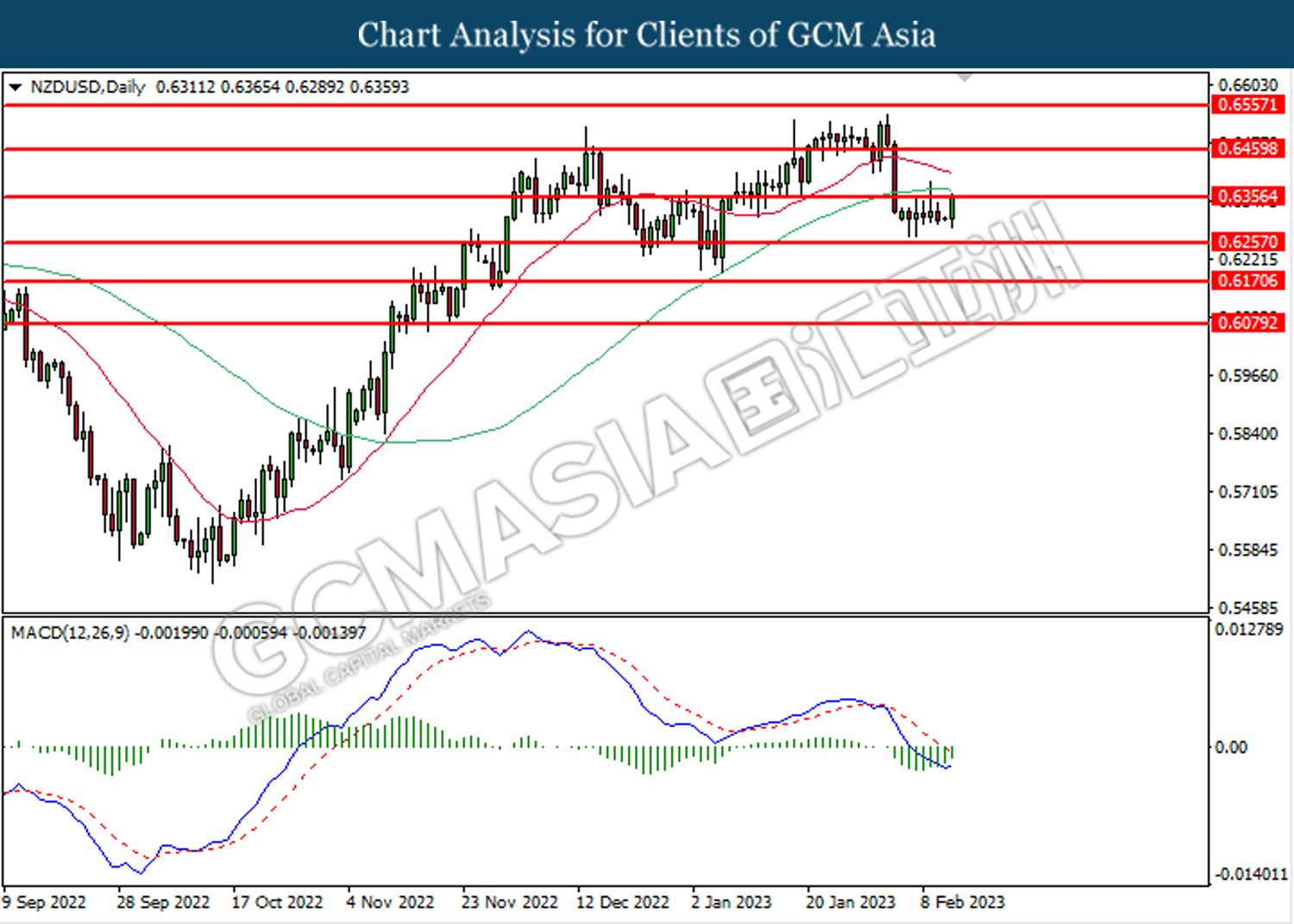

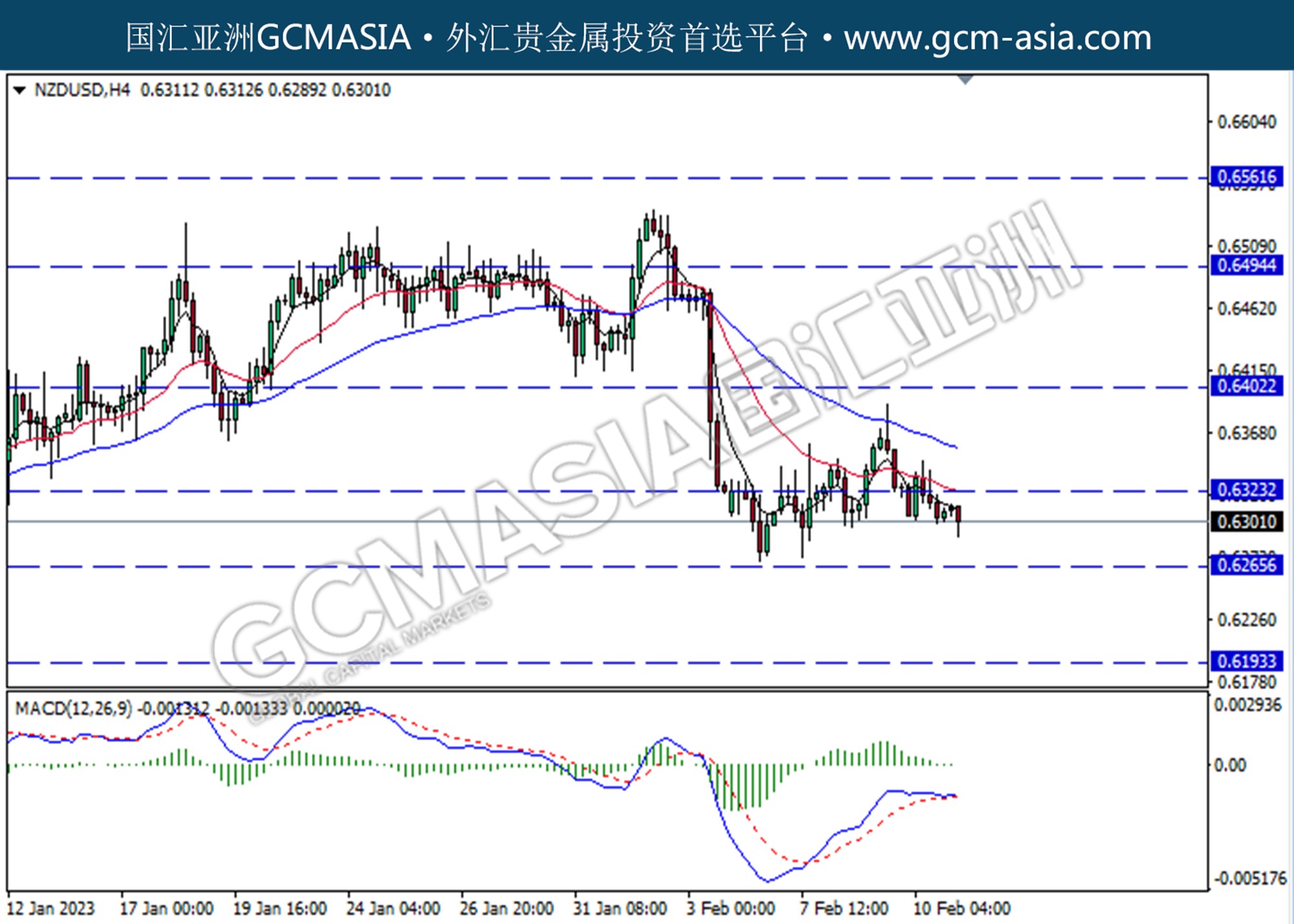

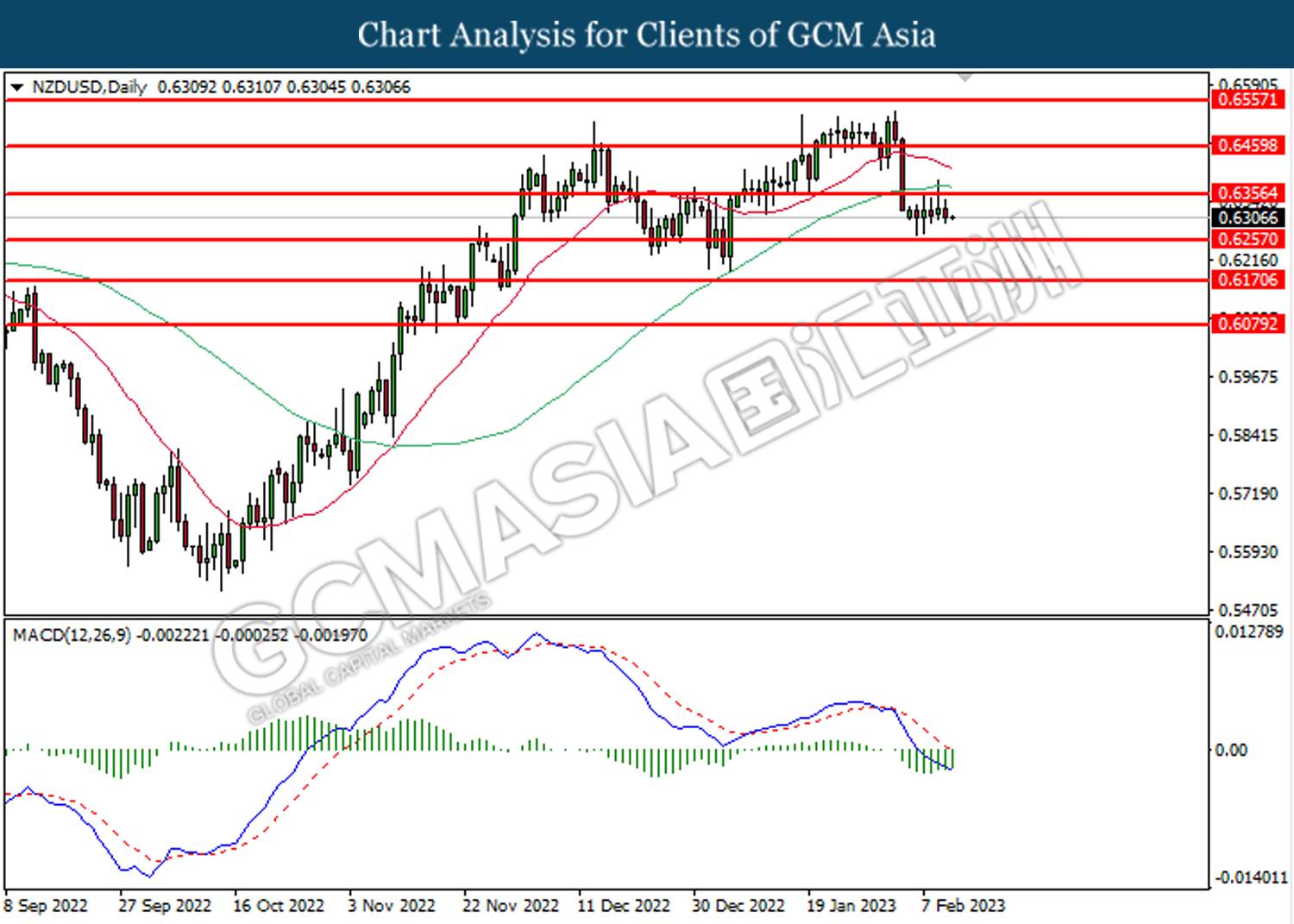

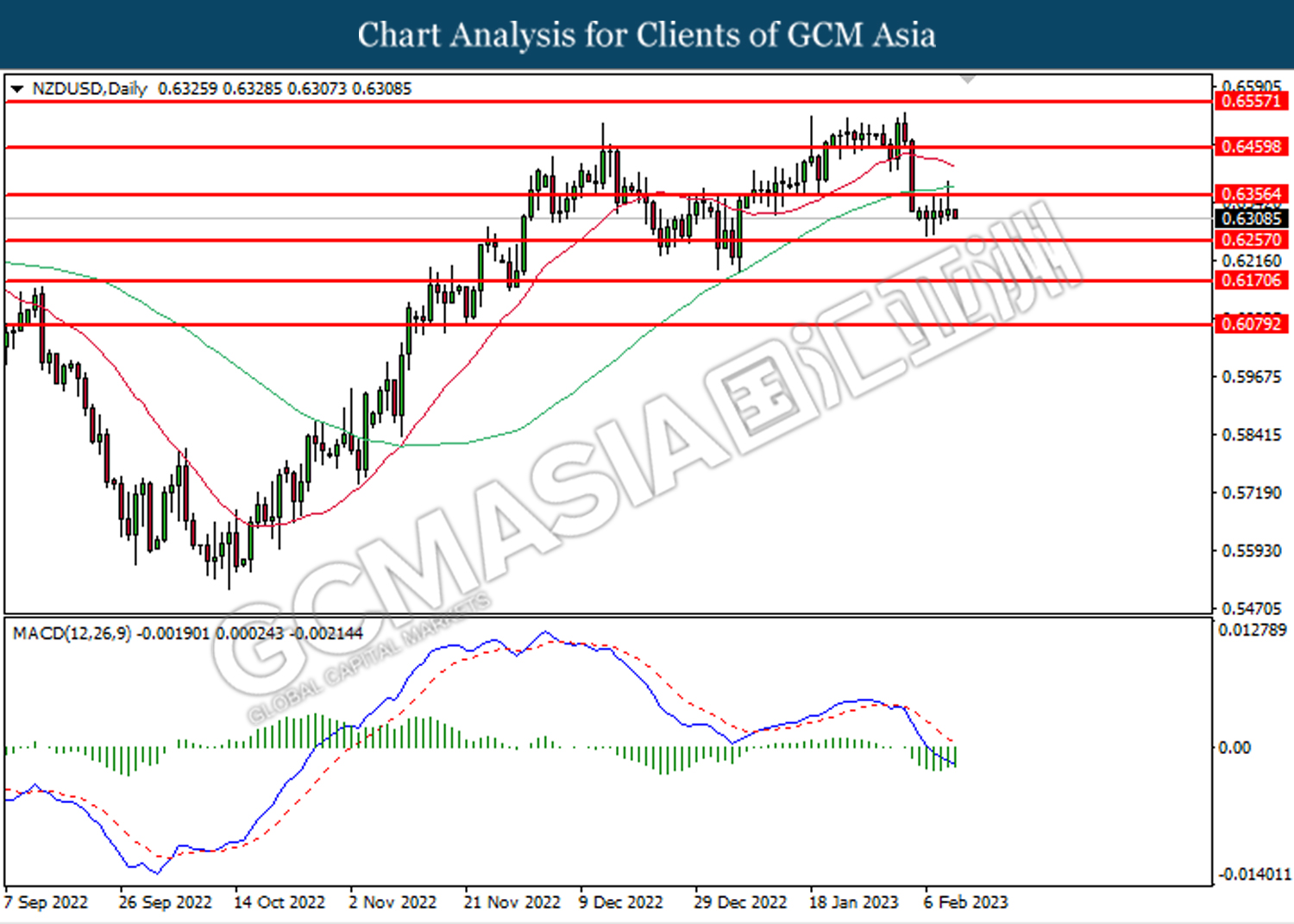

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from a higher level. However, MACD which illustrated increasing bullish momentum suggests the pair to traded higher as a technical correction.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

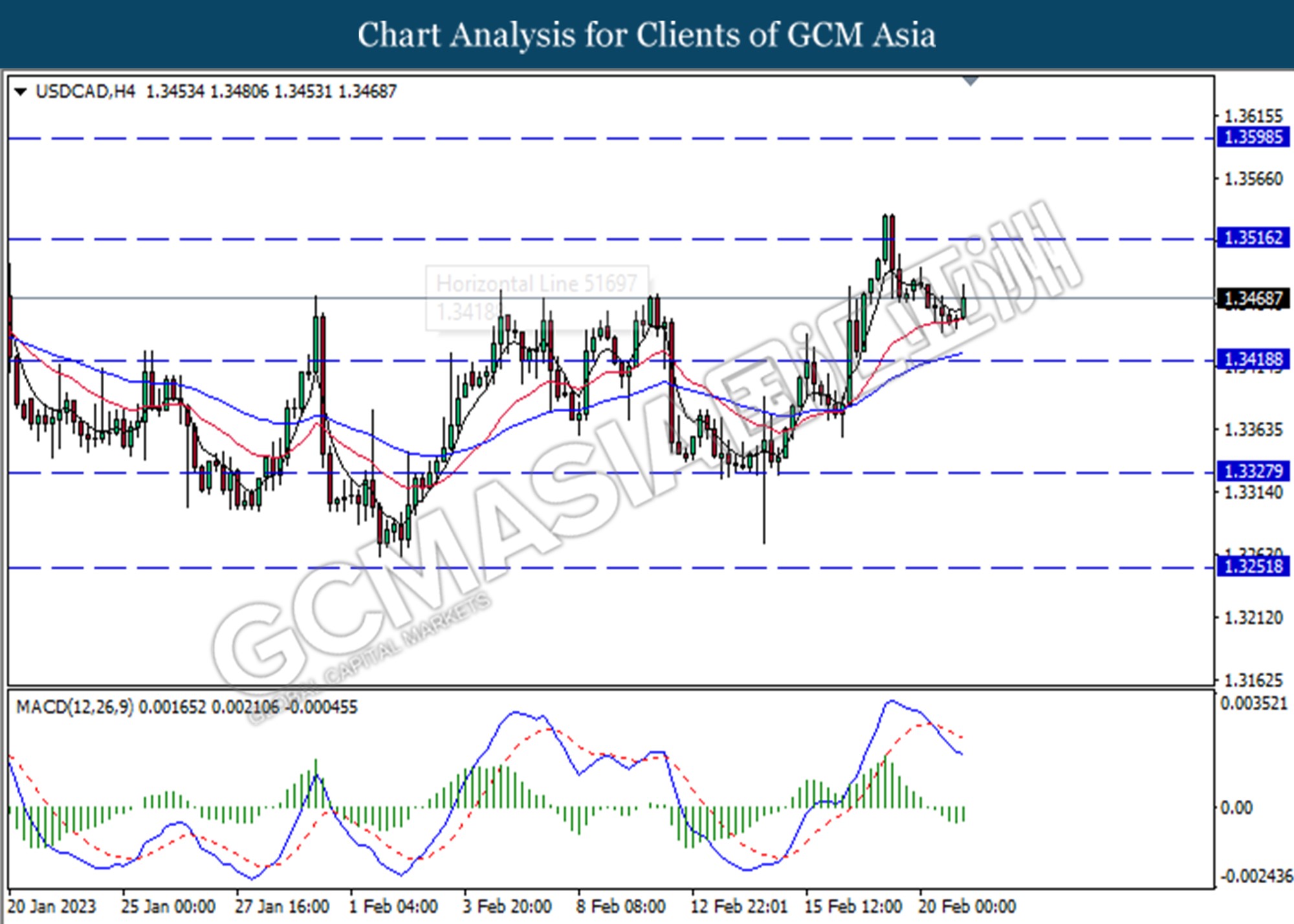

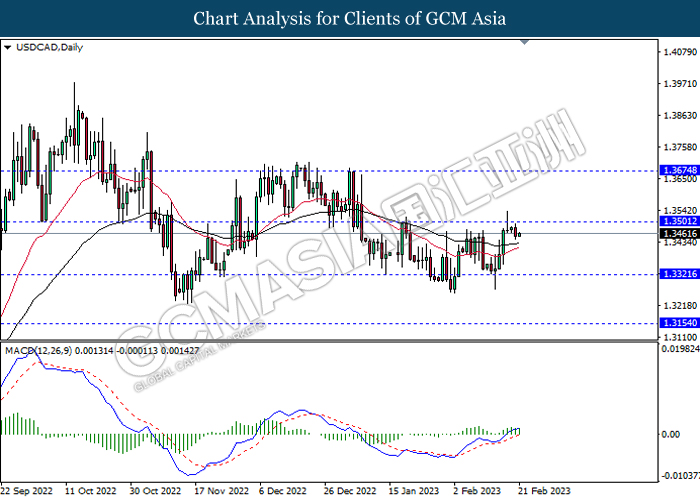

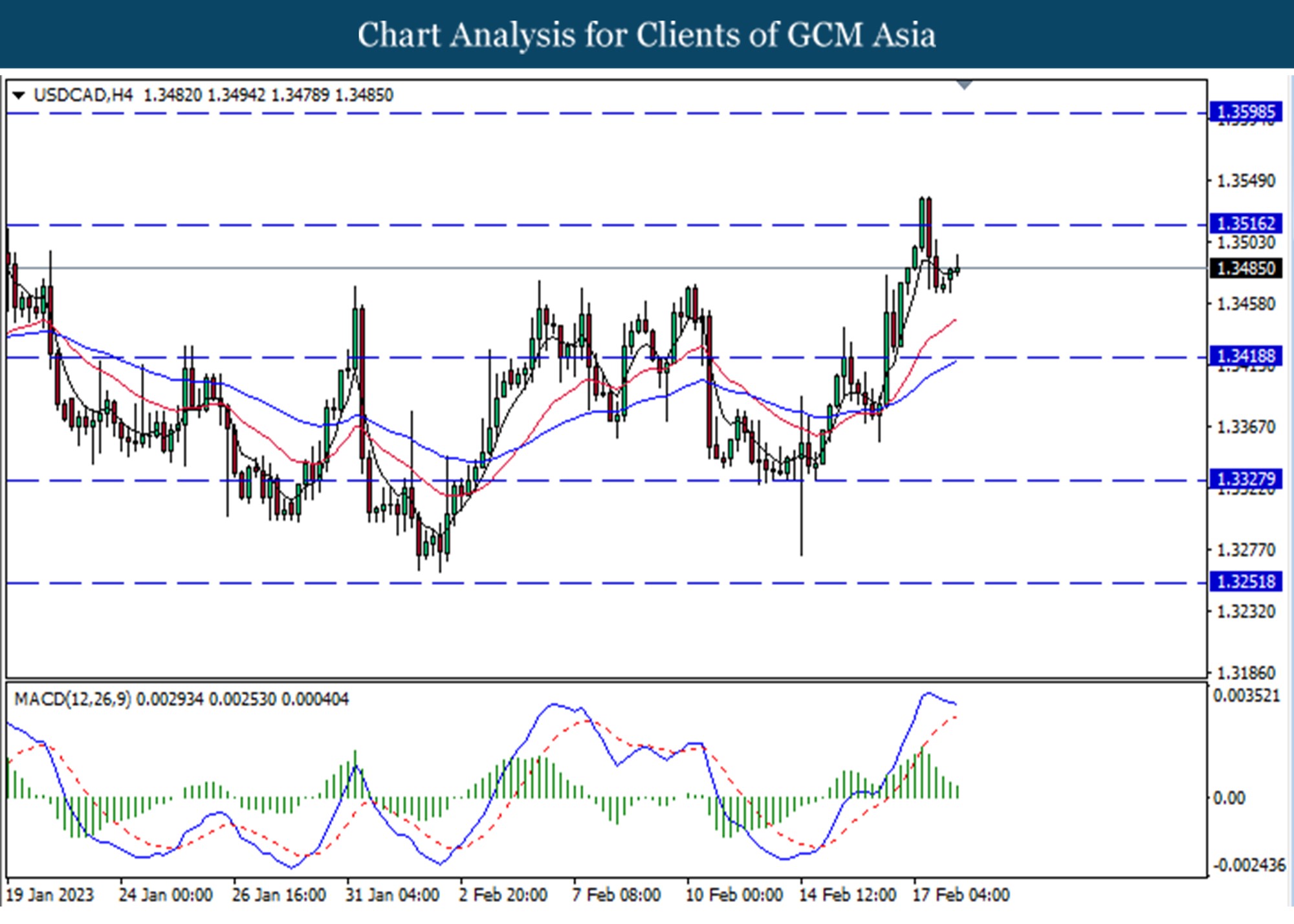

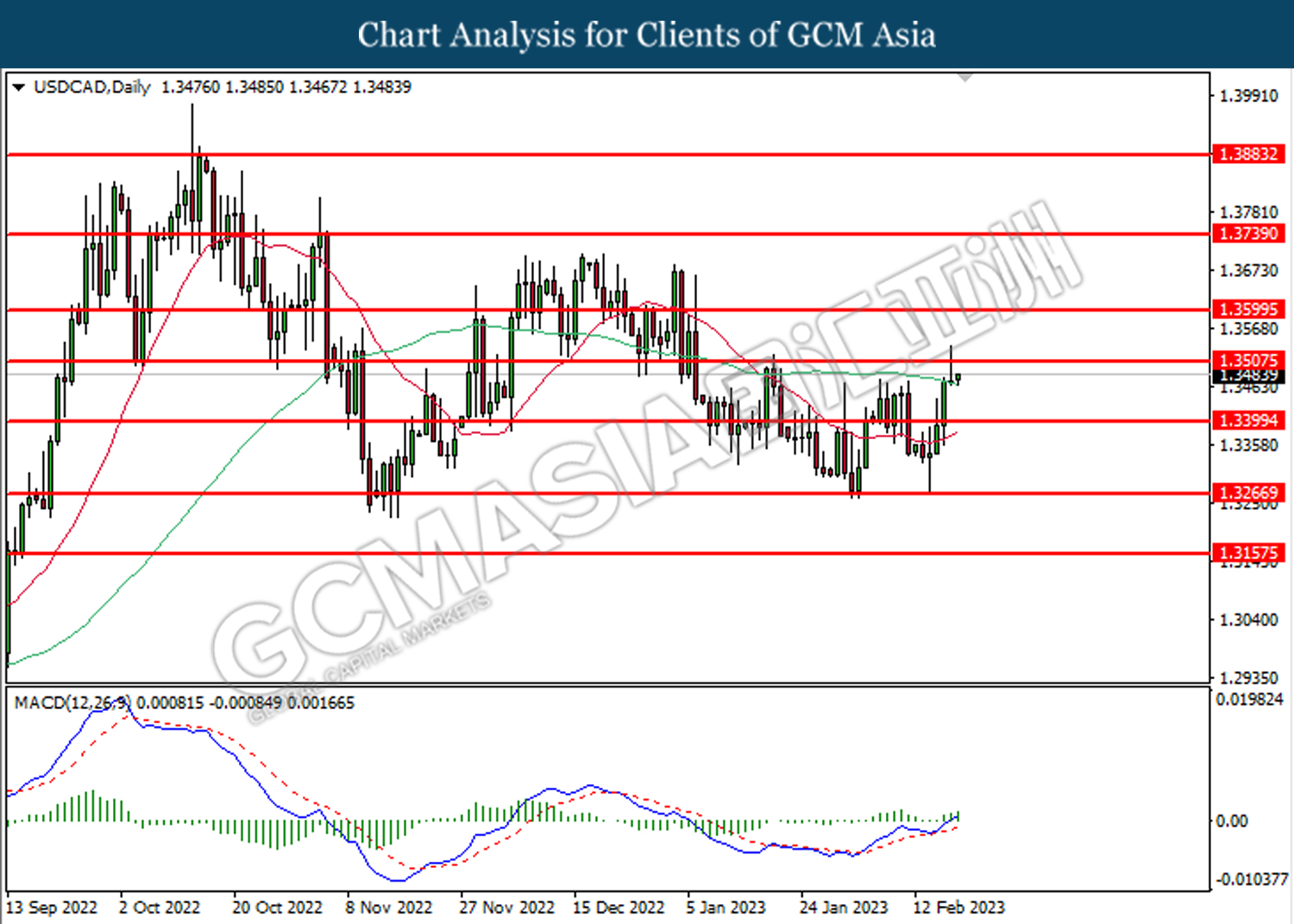

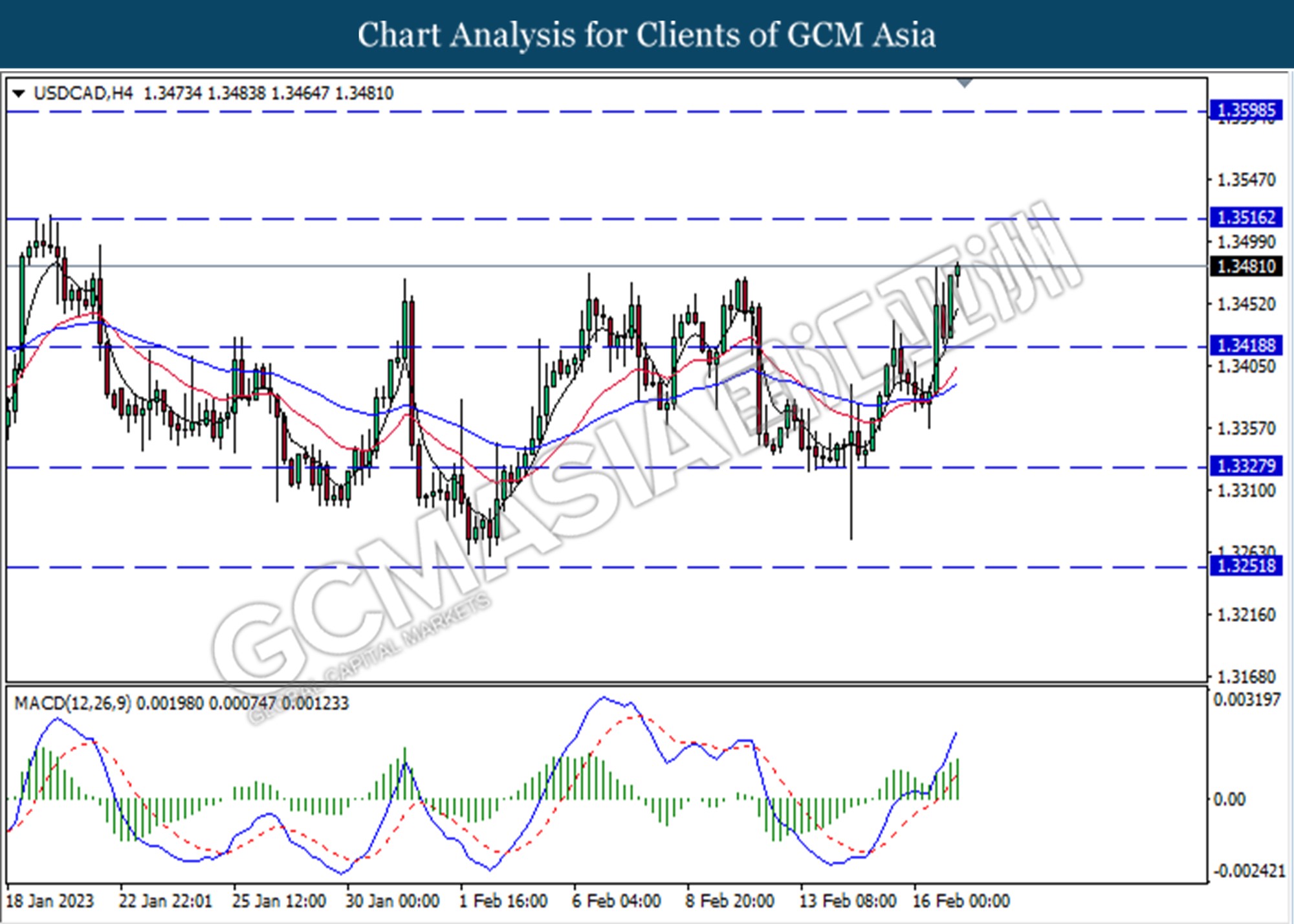

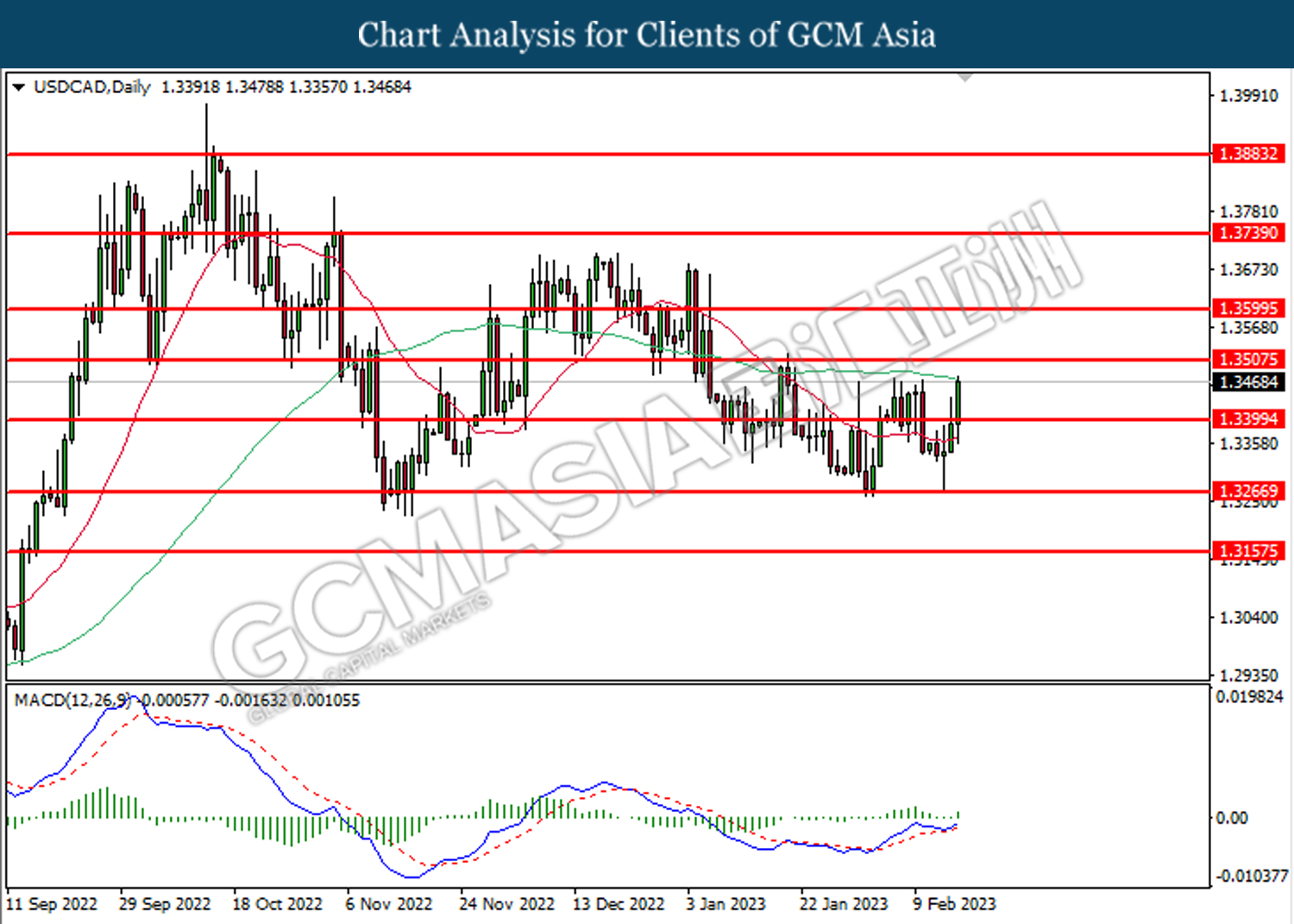

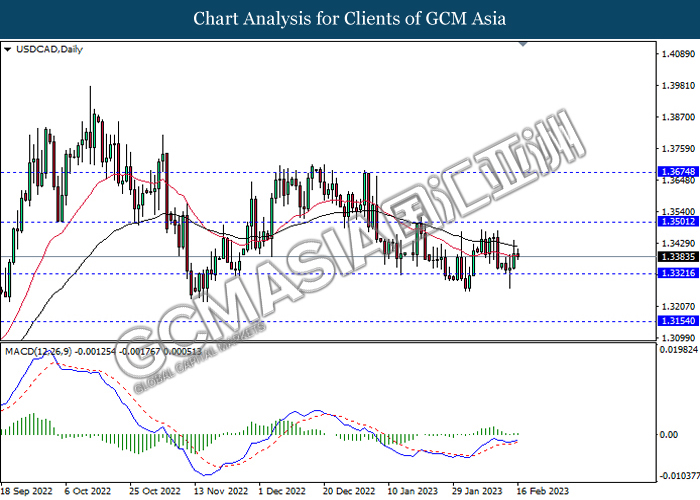

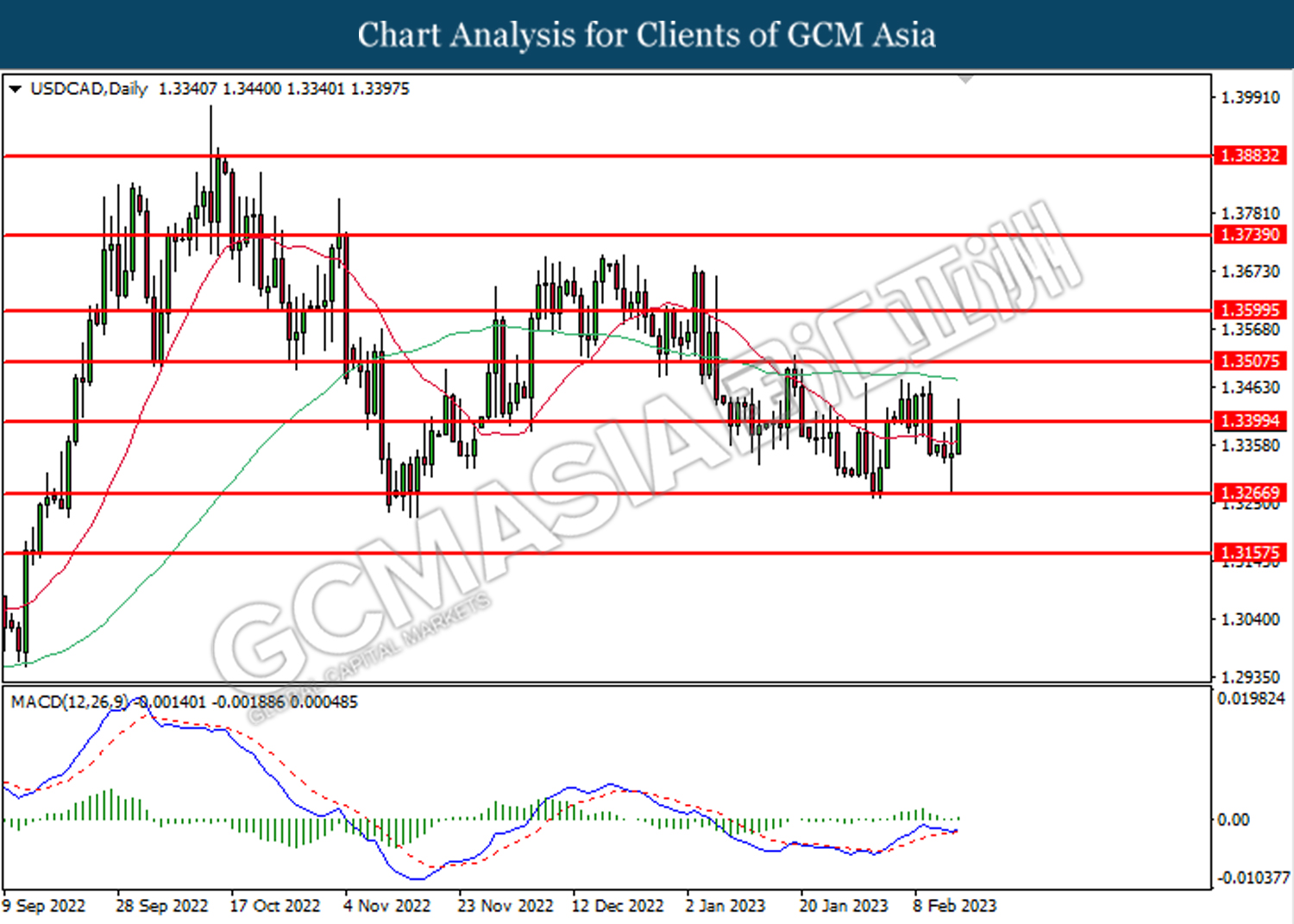

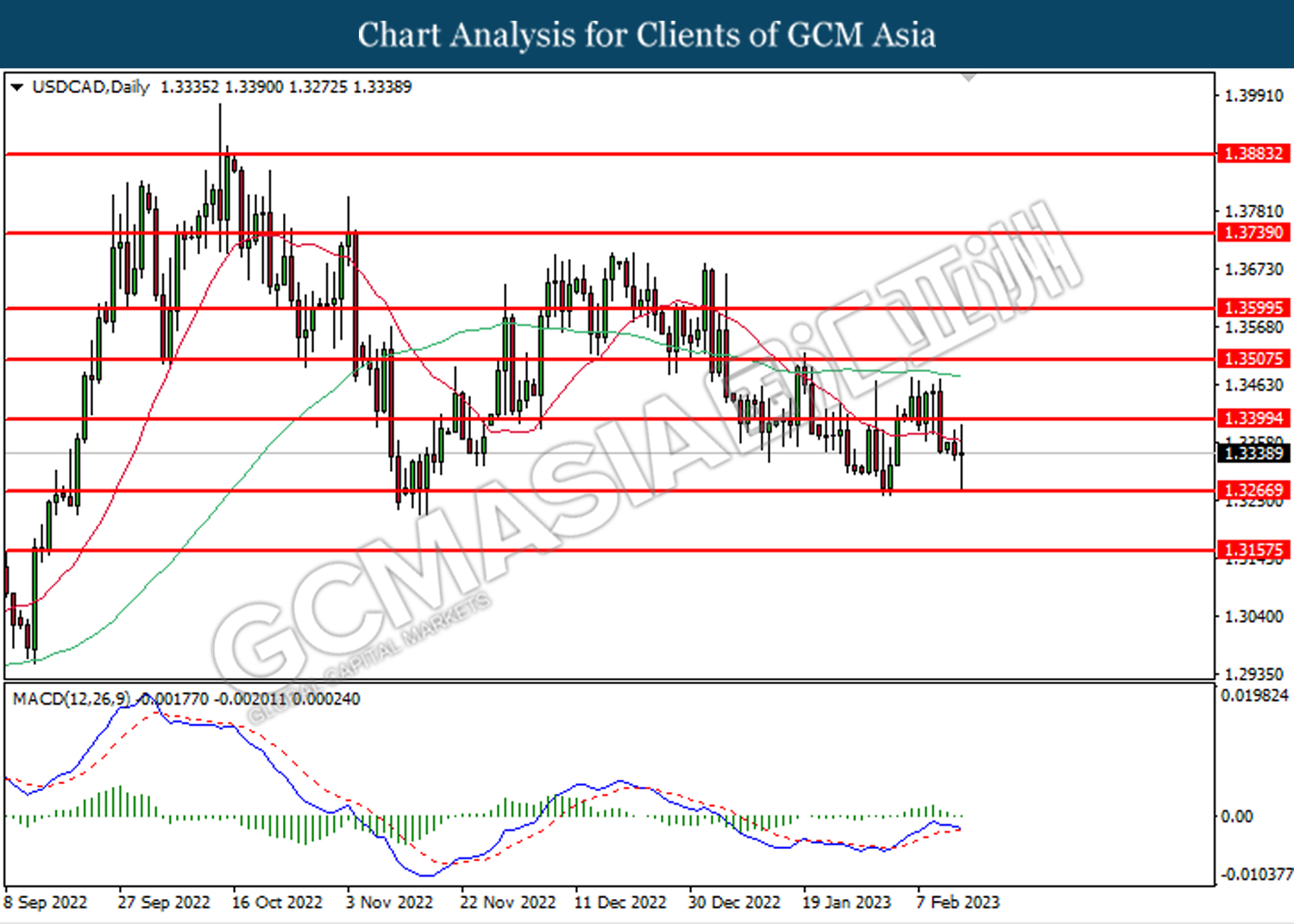

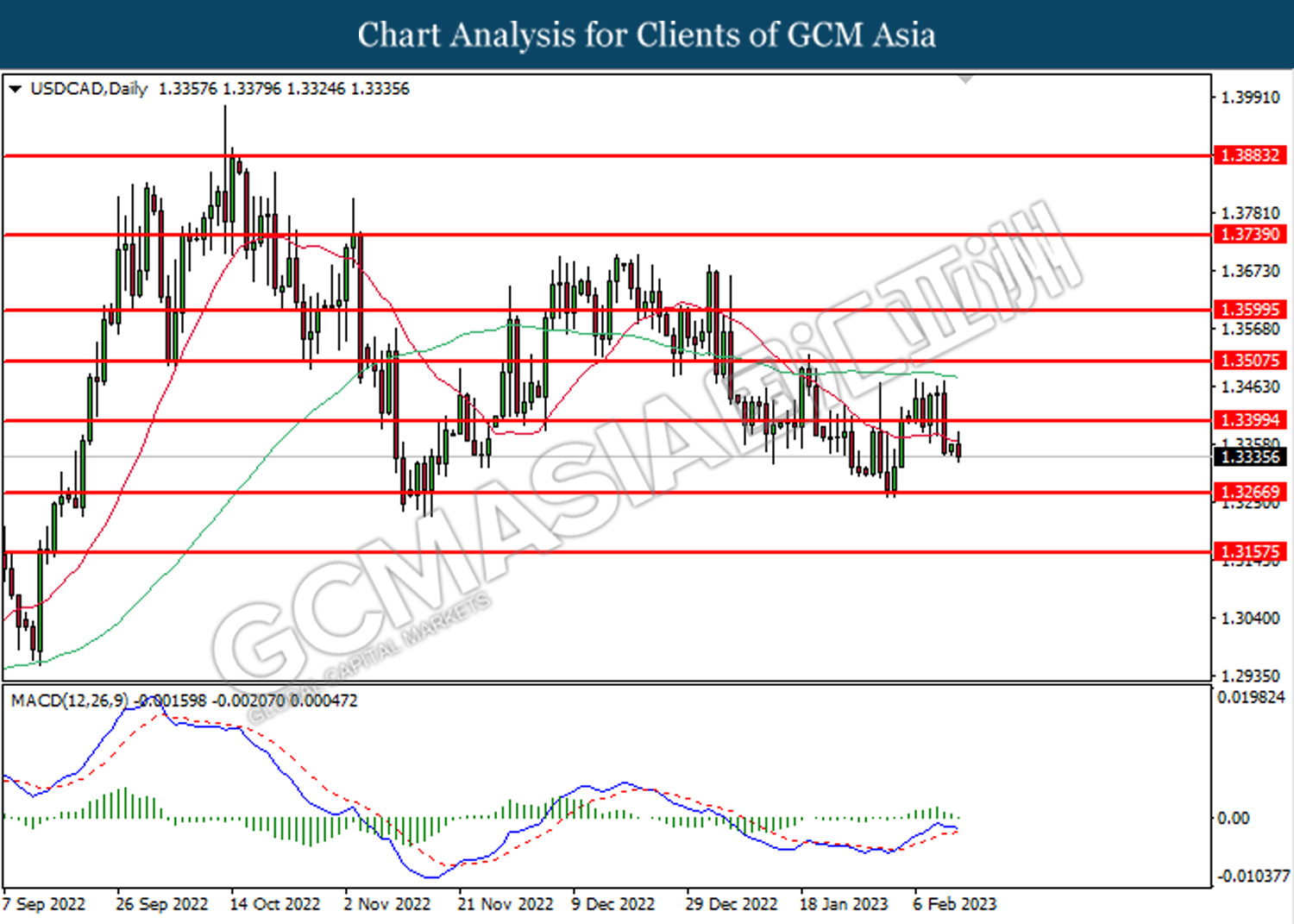

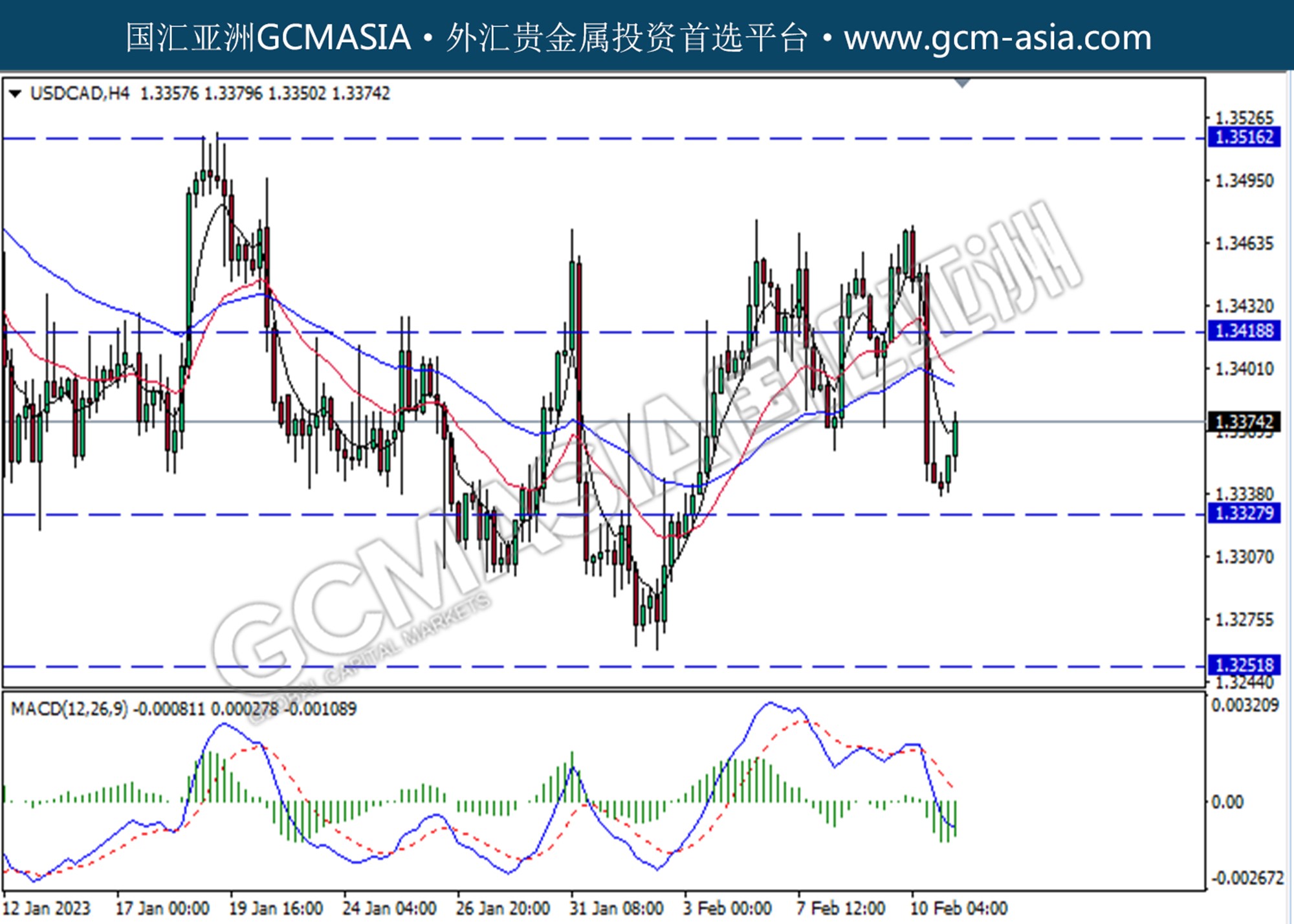

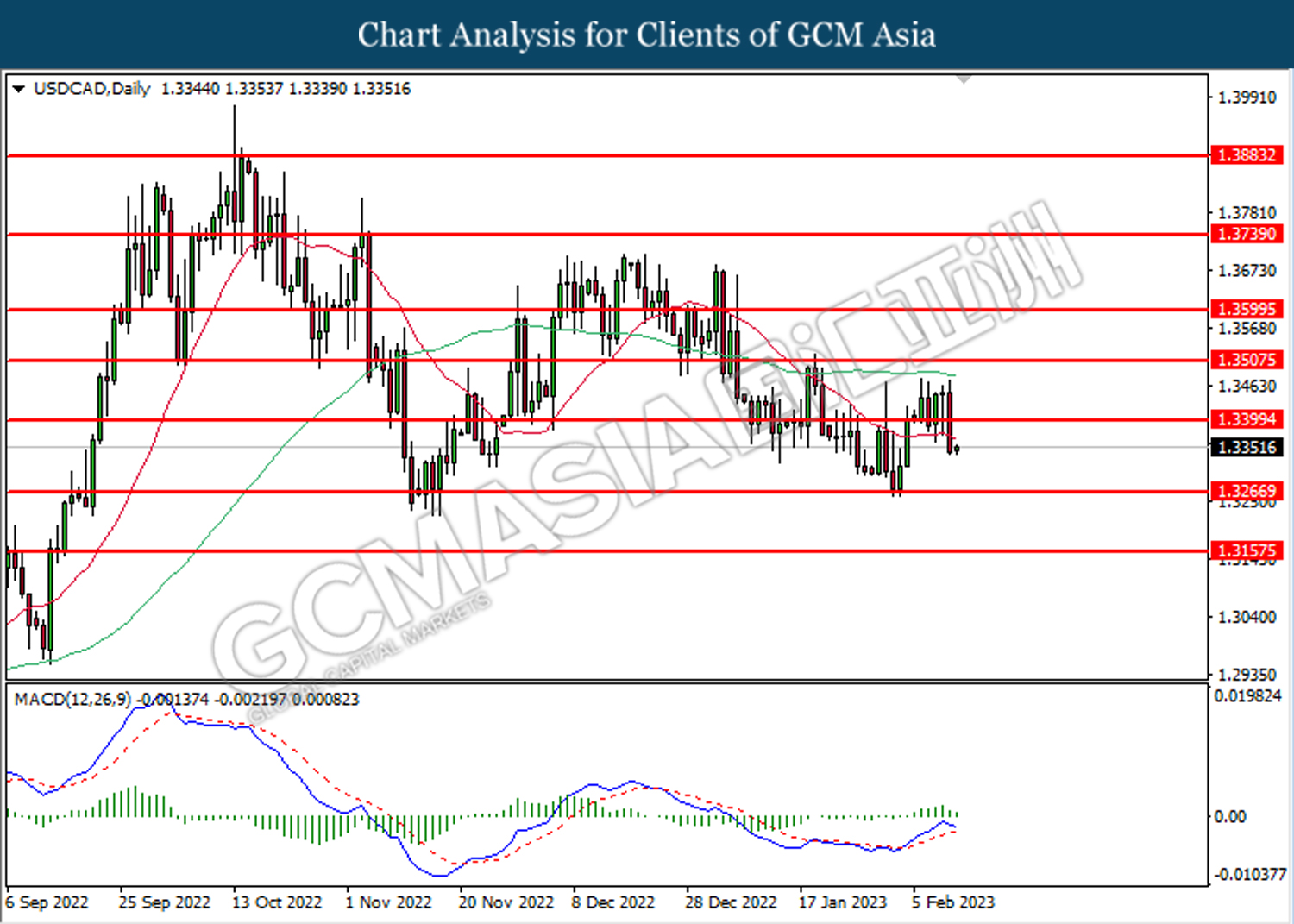

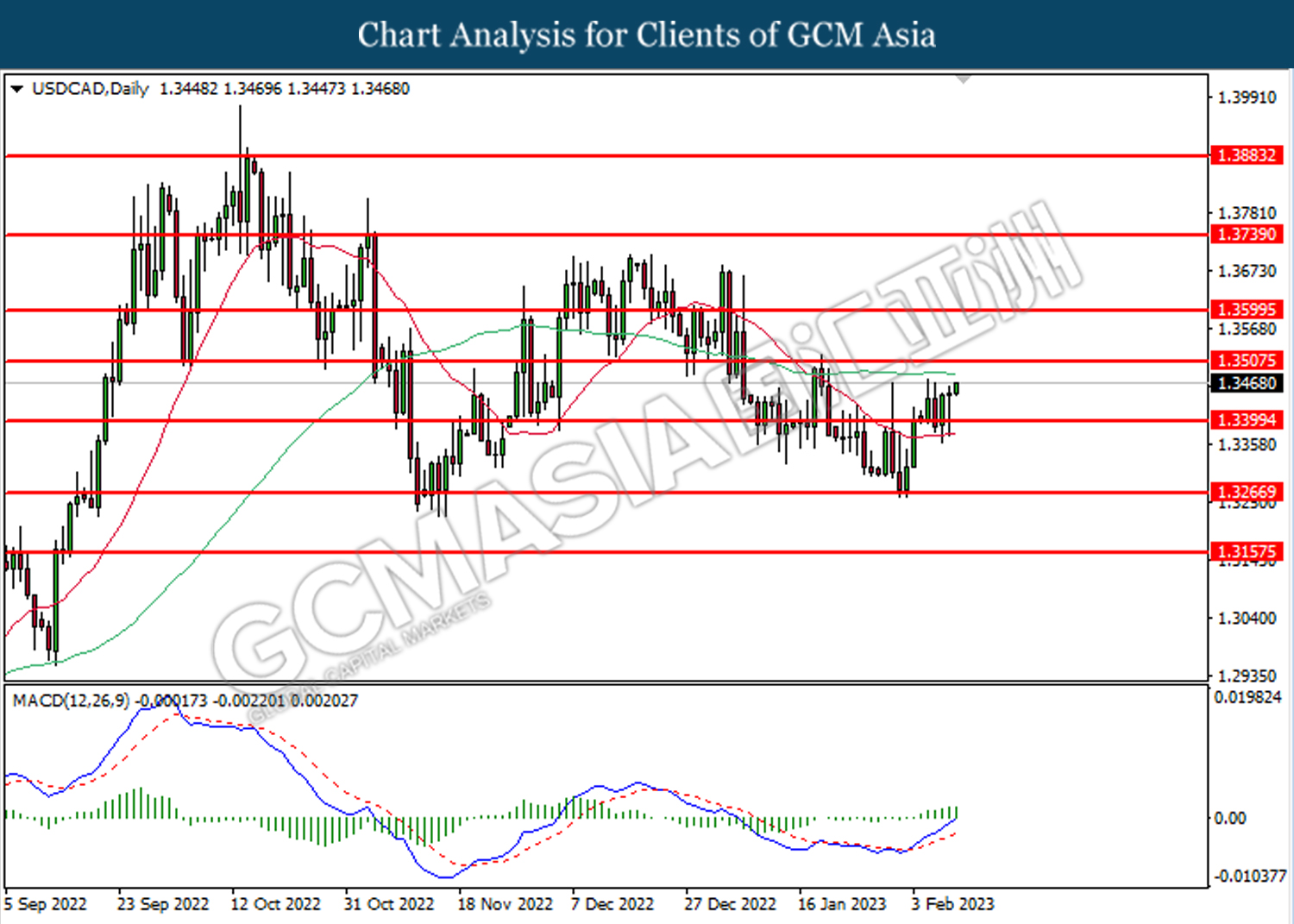

USDCAD, H4: USDCAD was traded higher following a prior rebound from the lowest level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

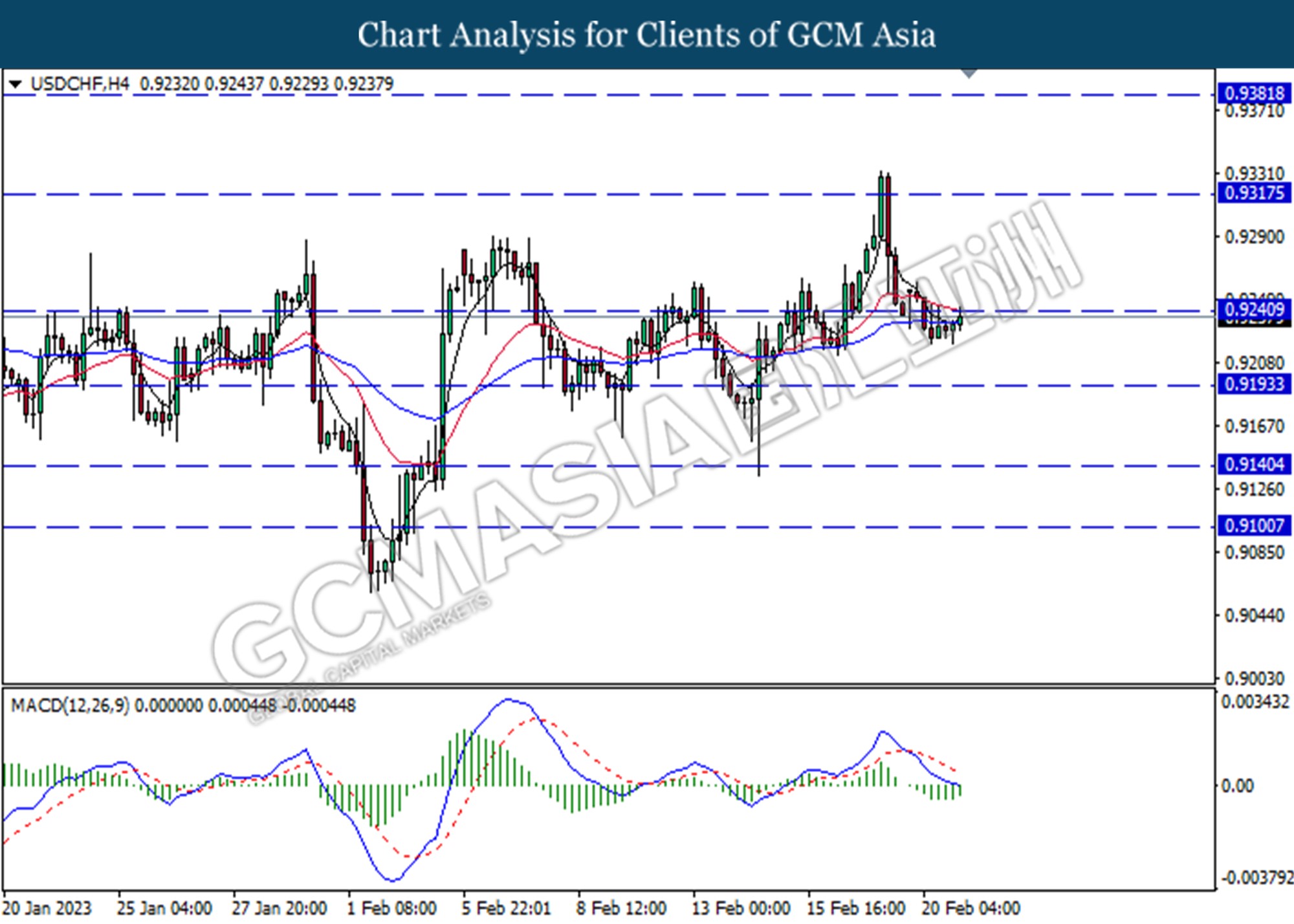

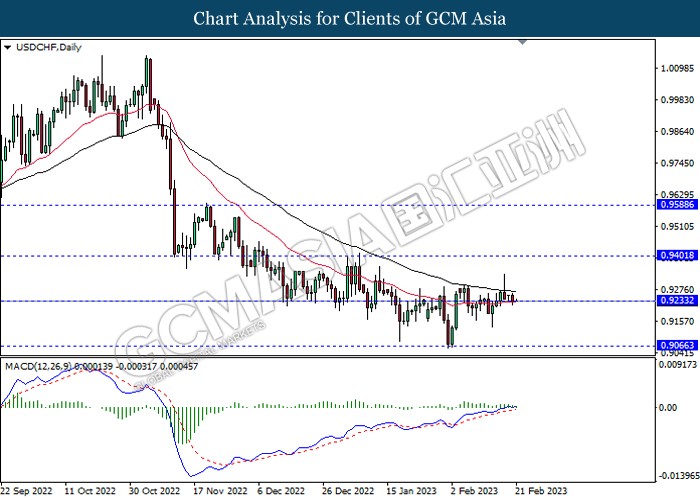

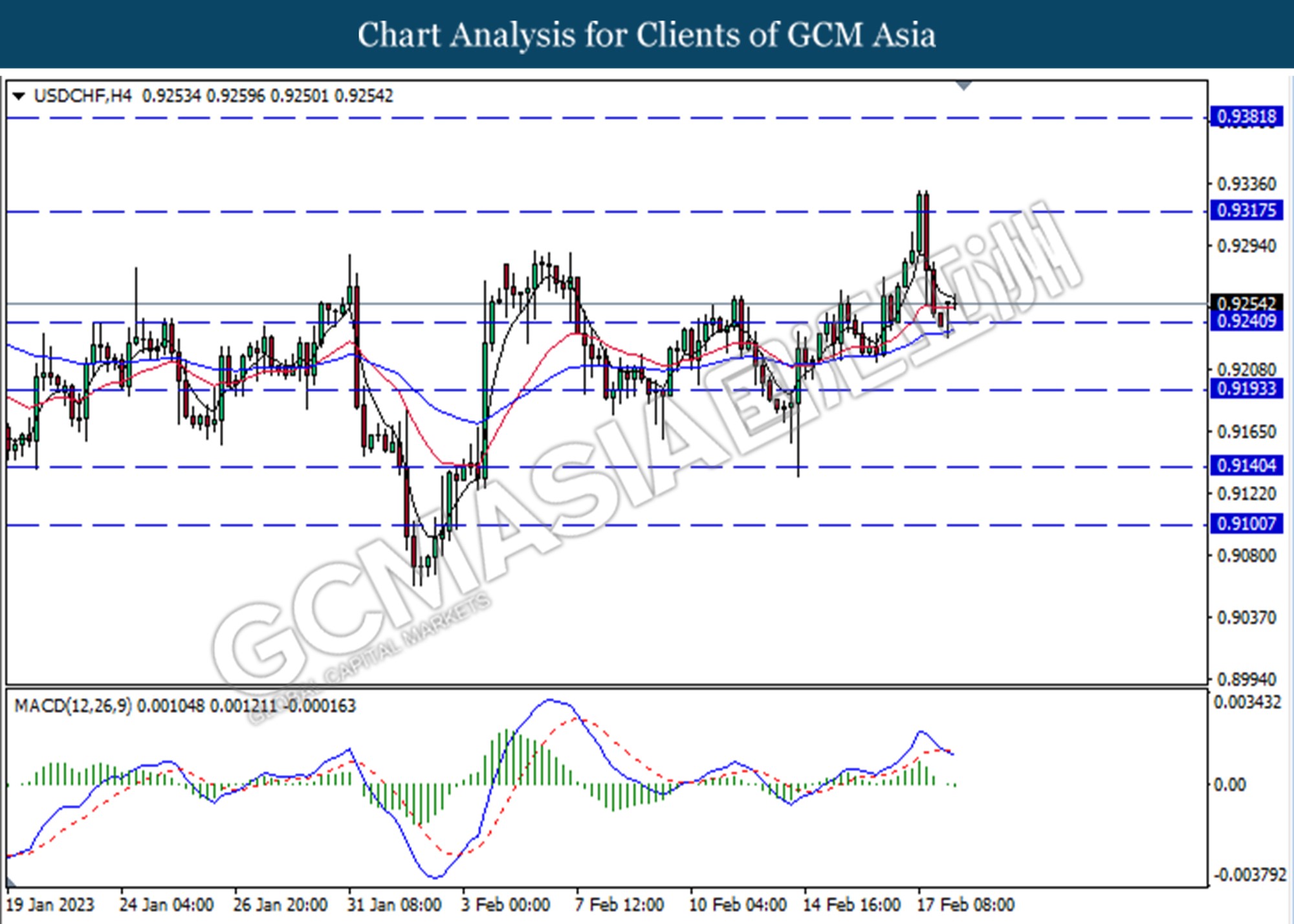

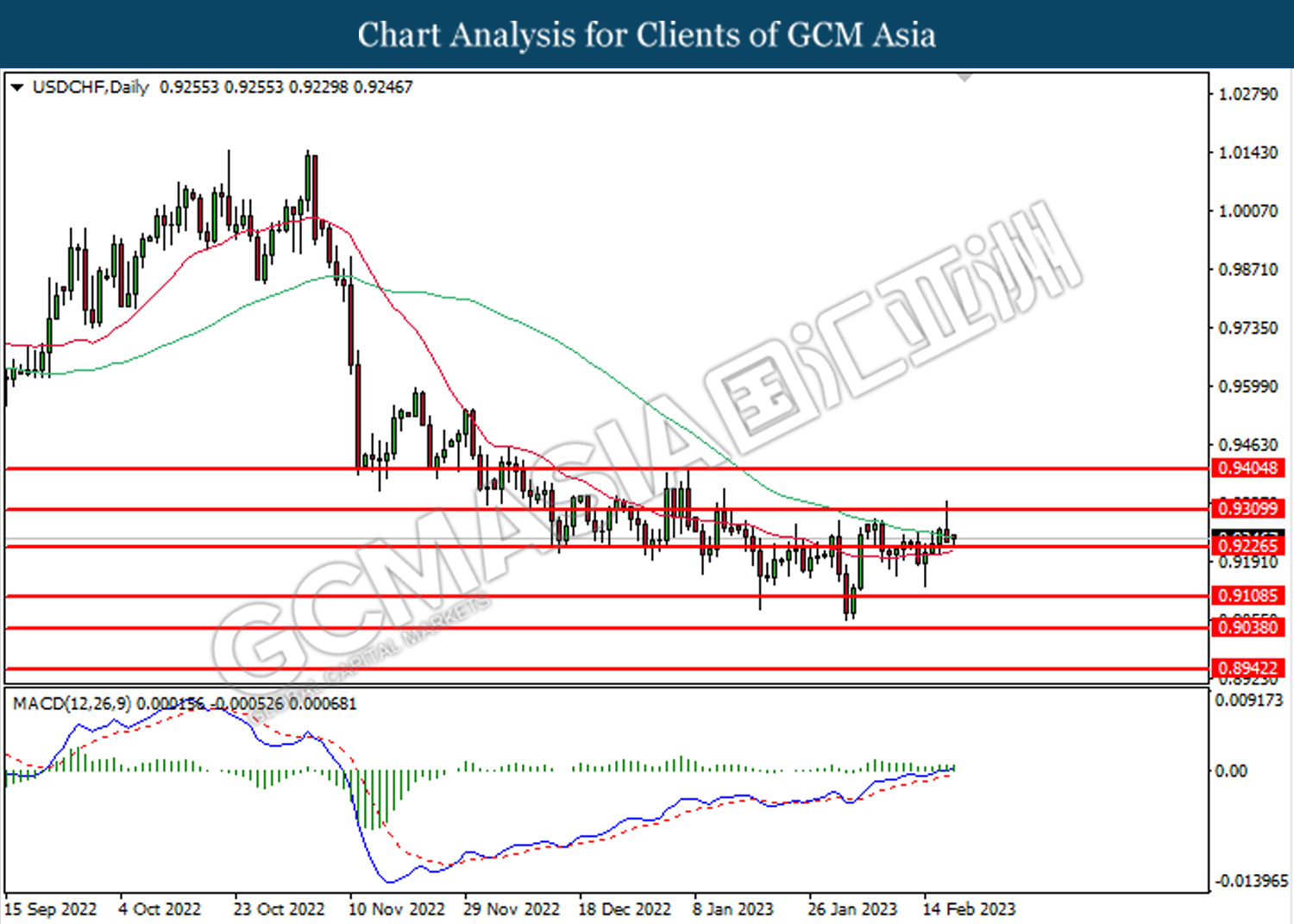

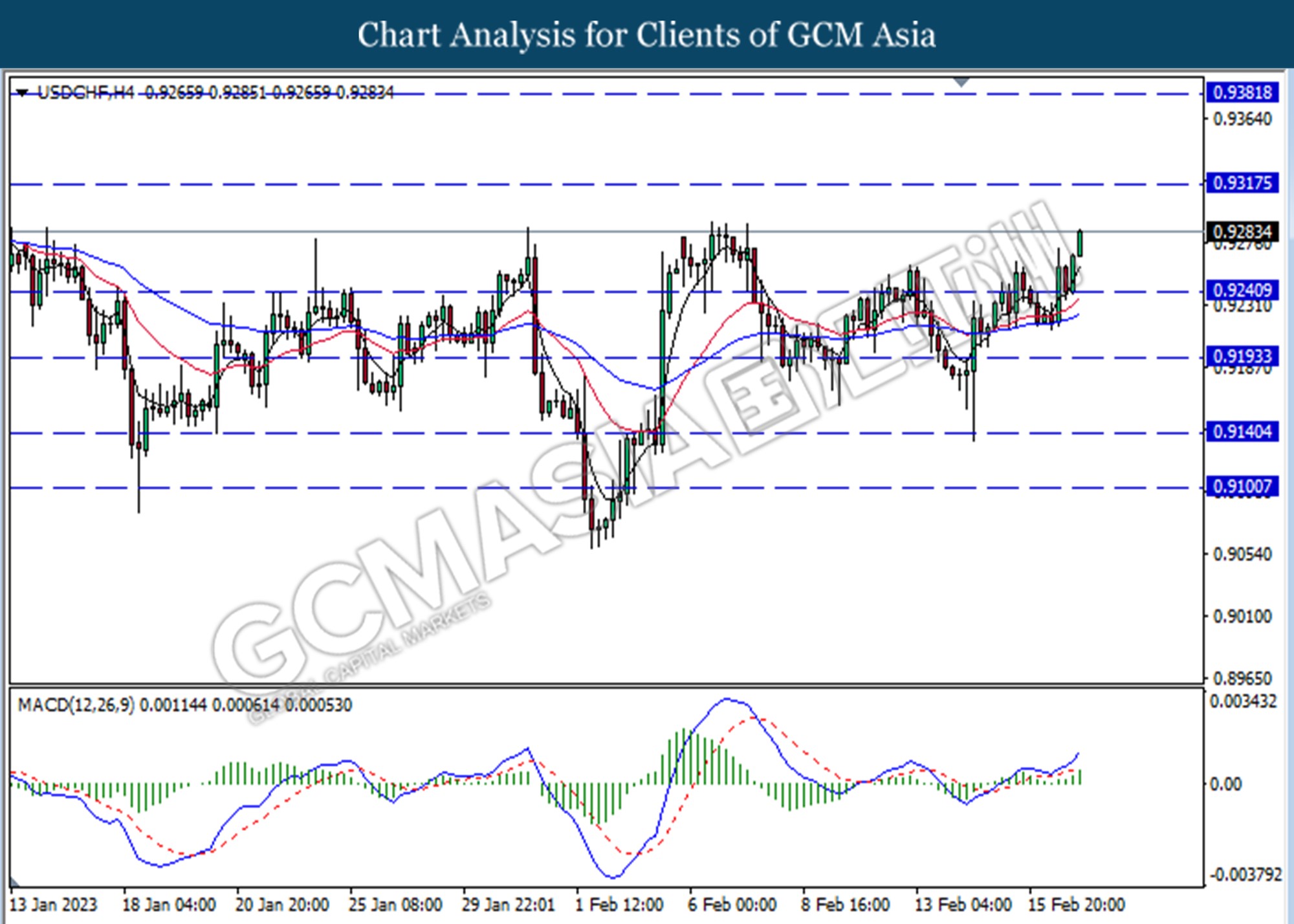

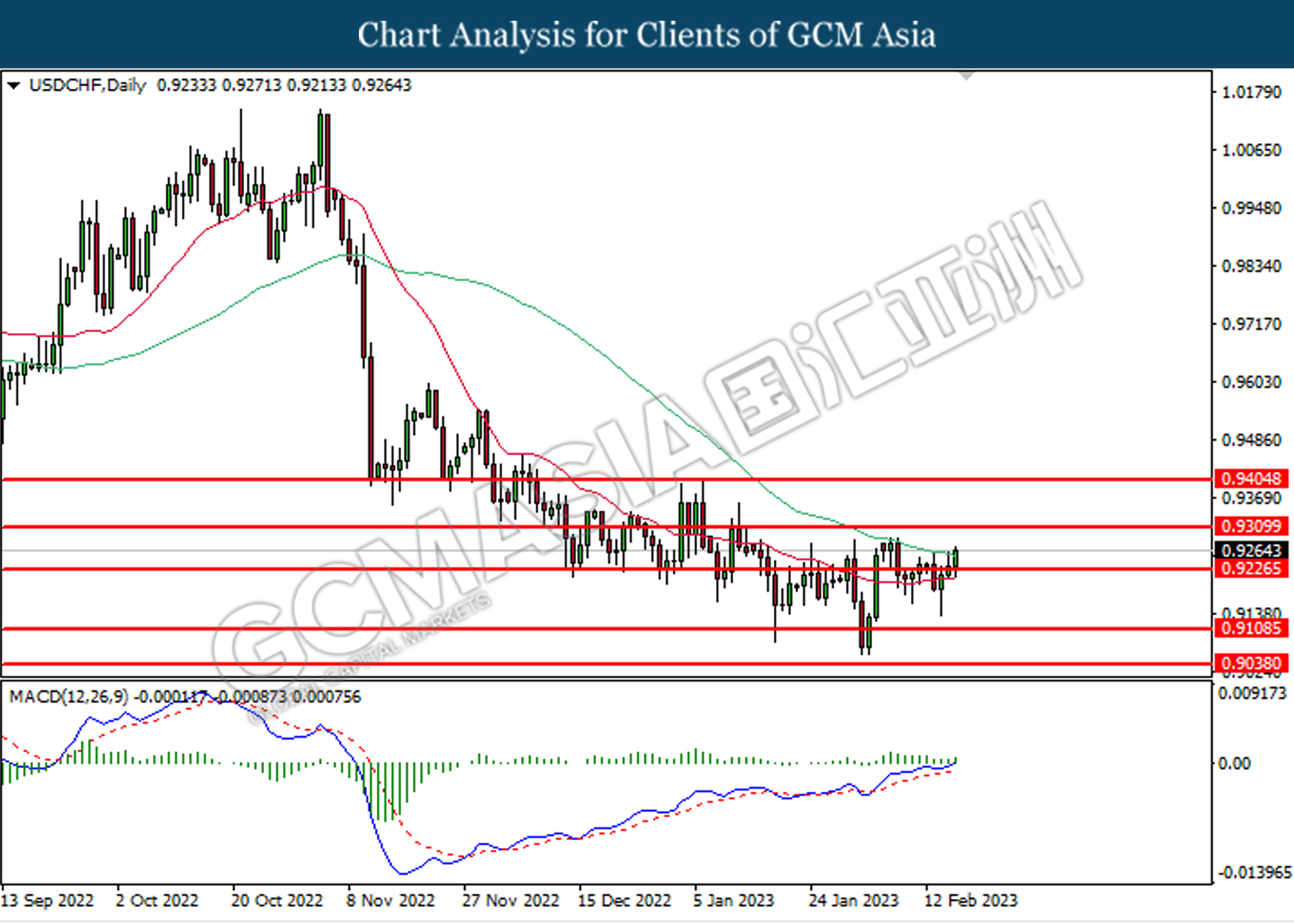

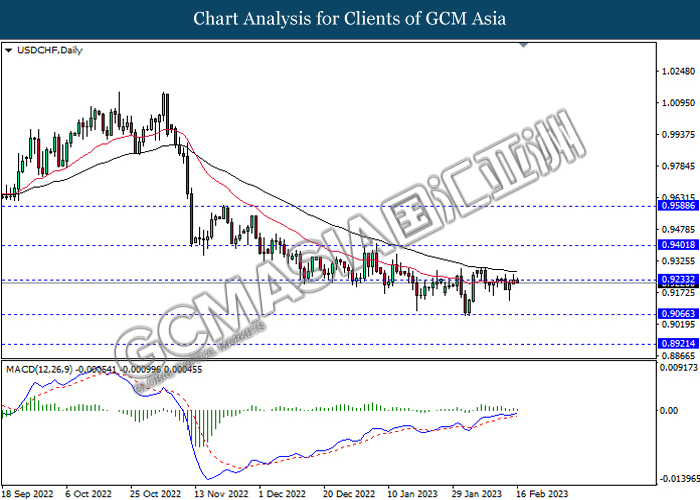

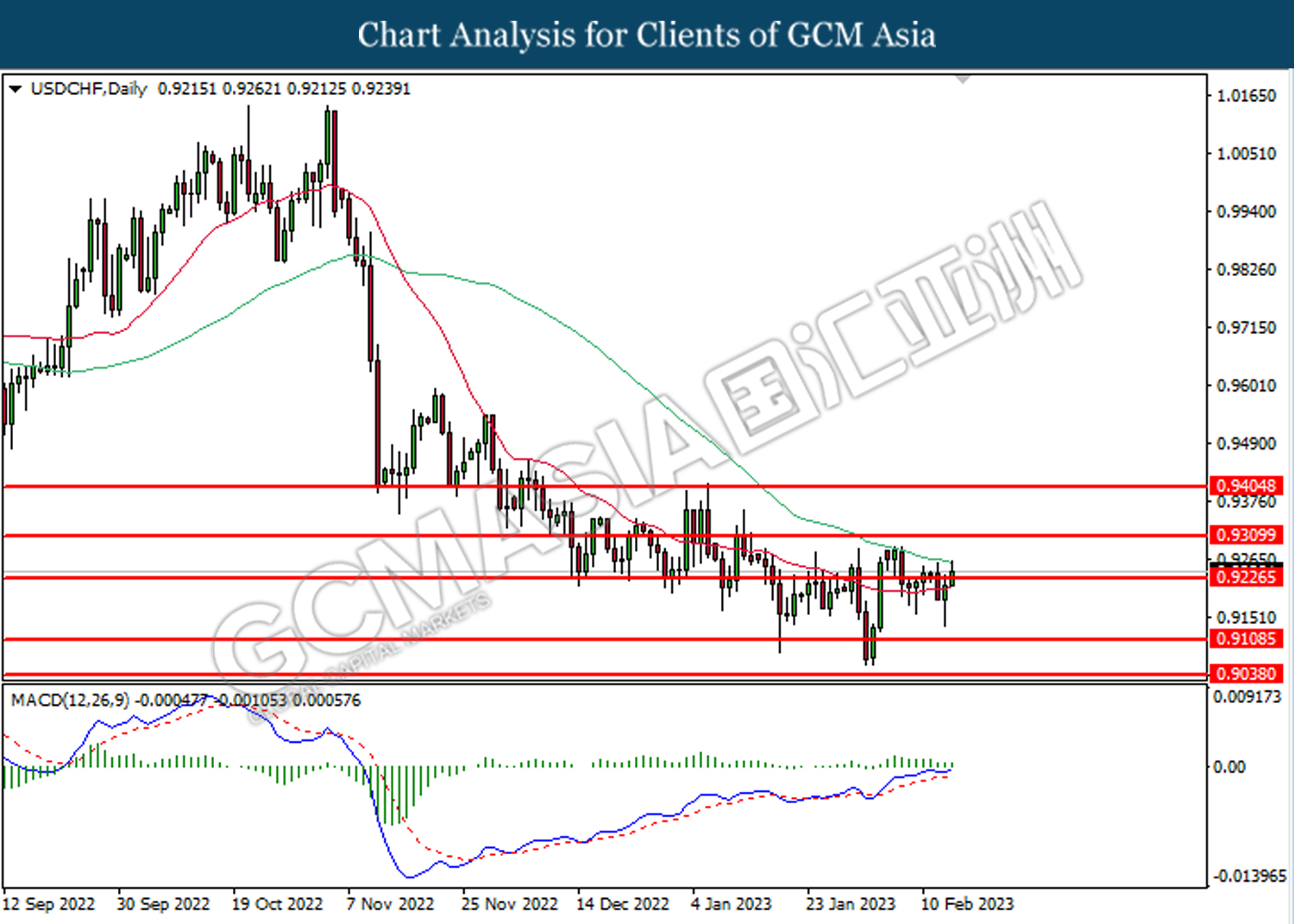

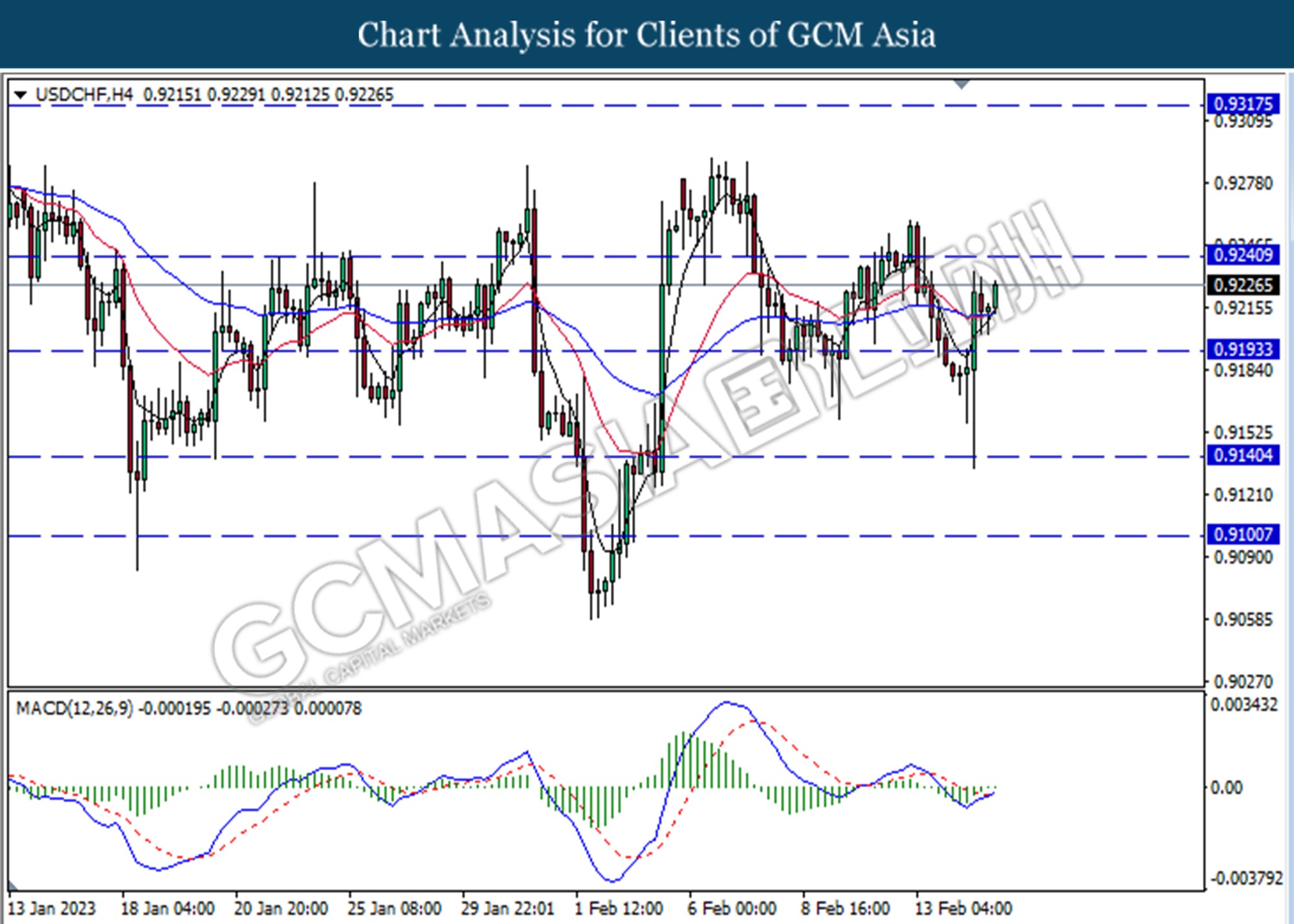

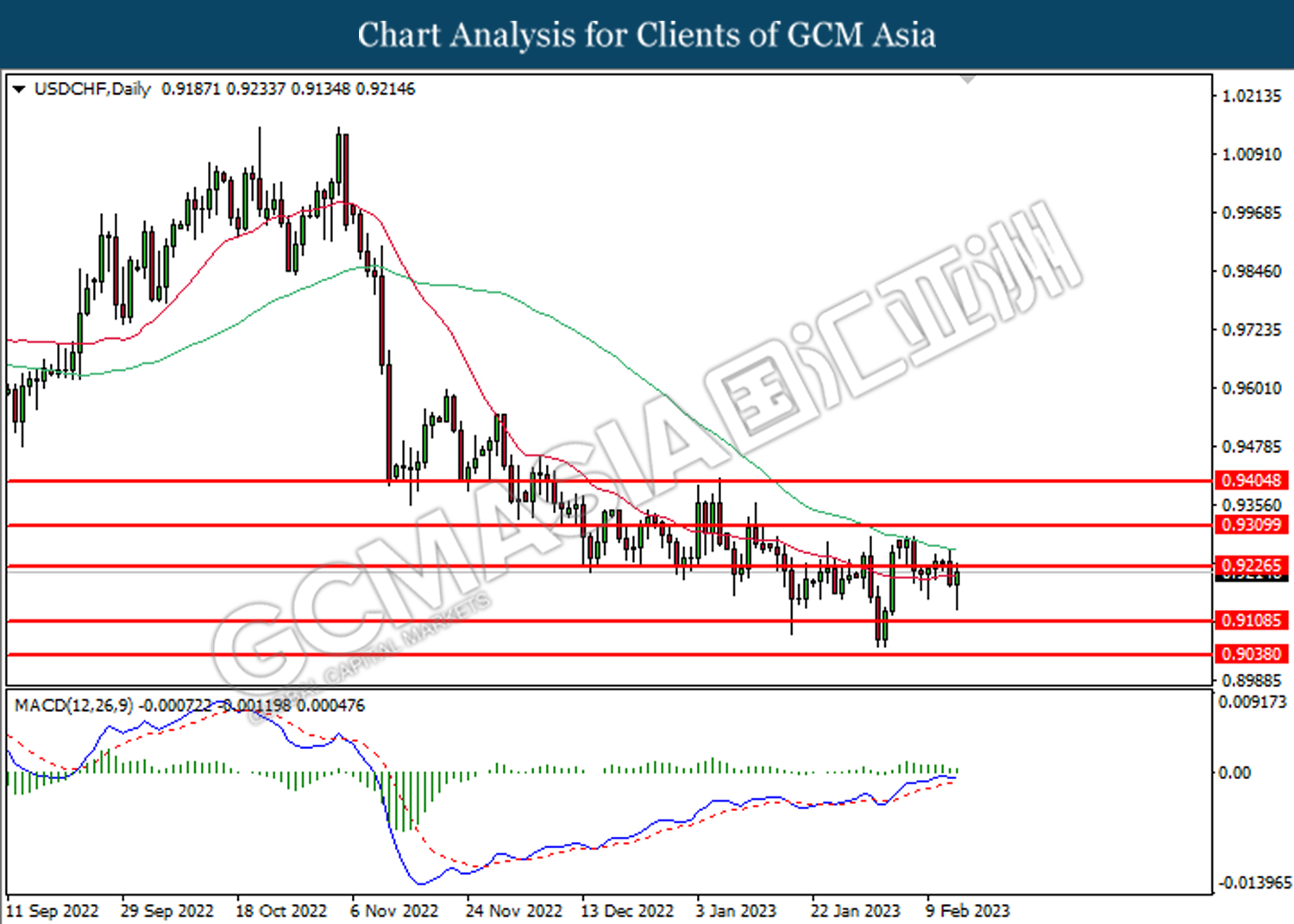

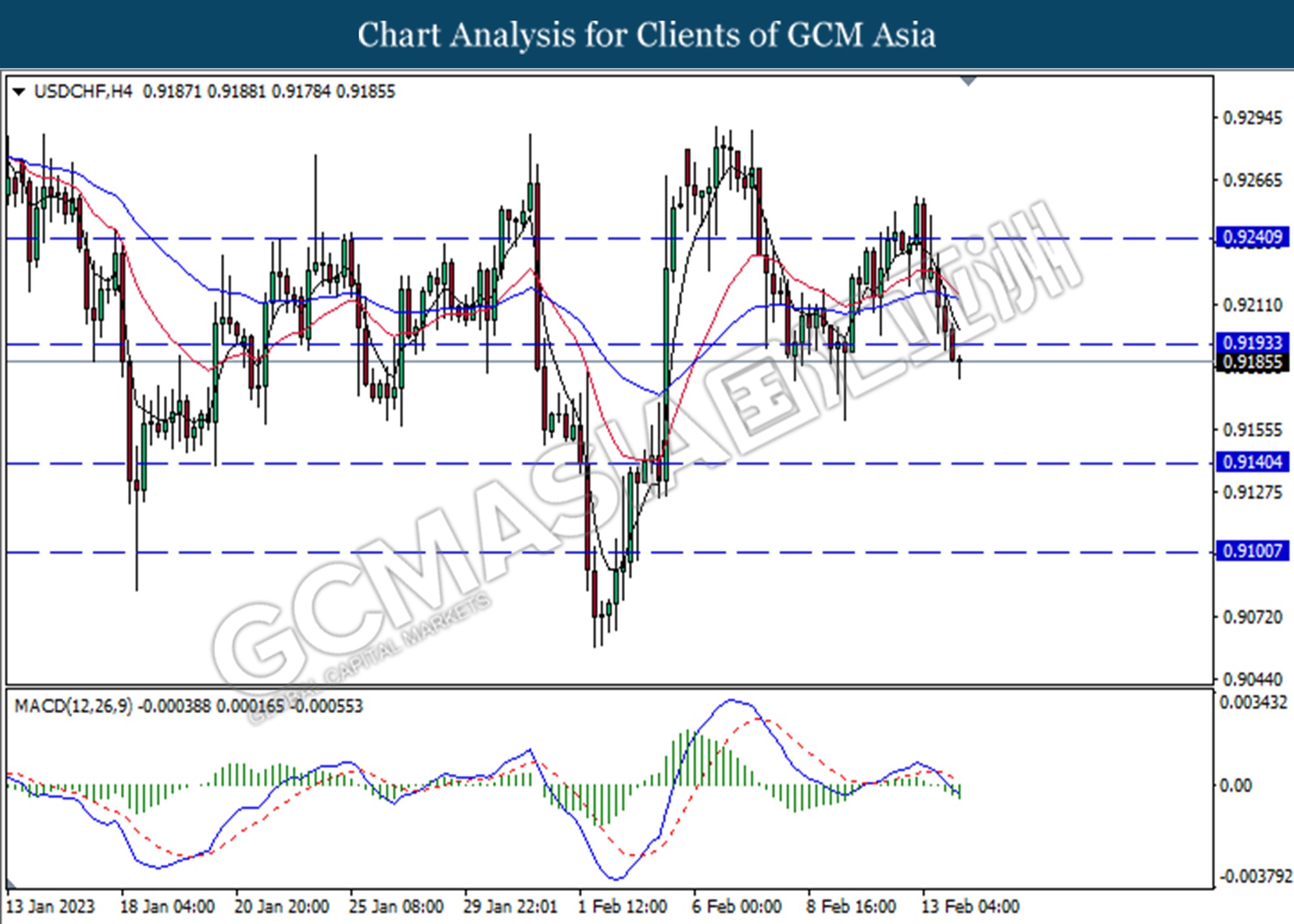

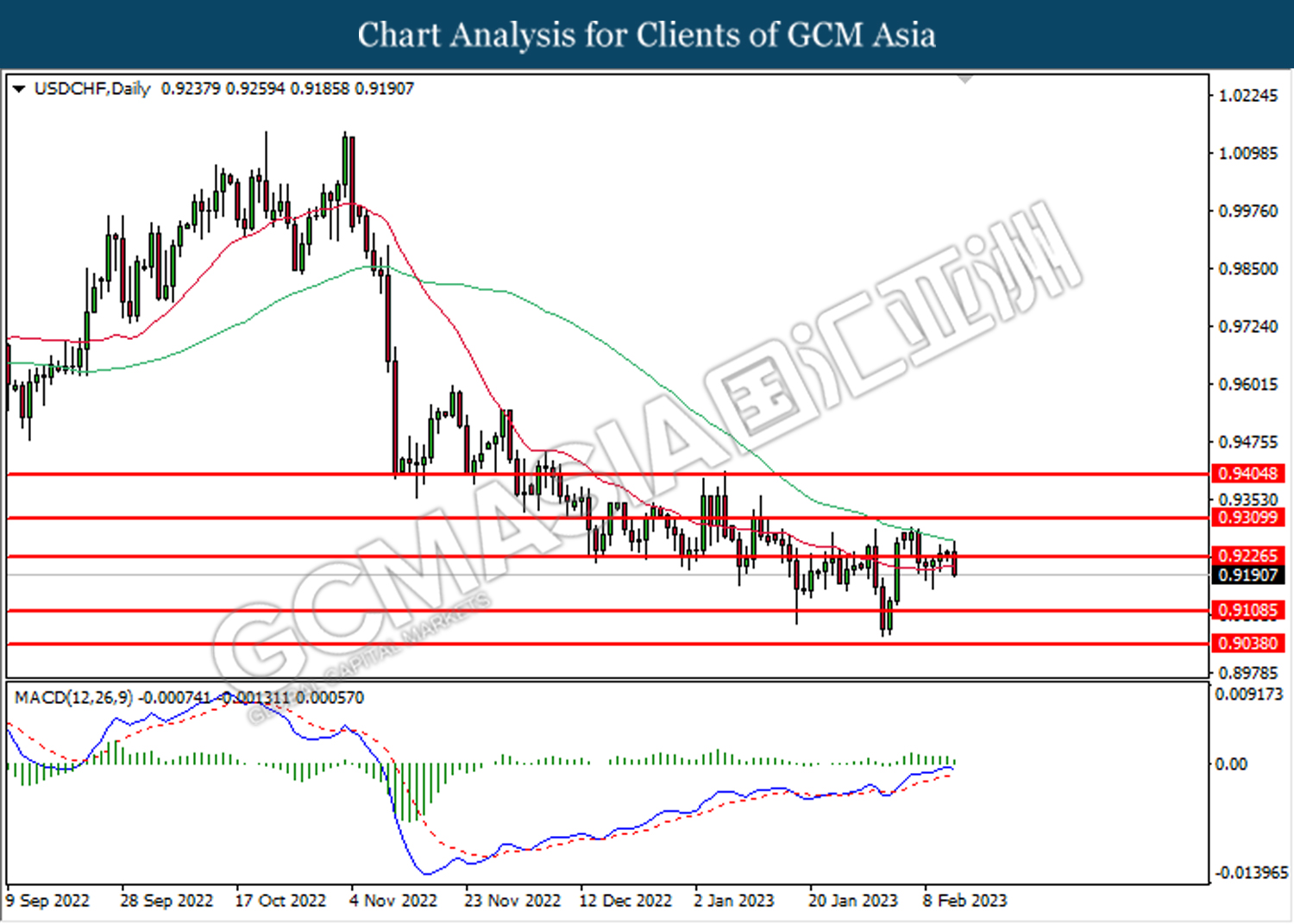

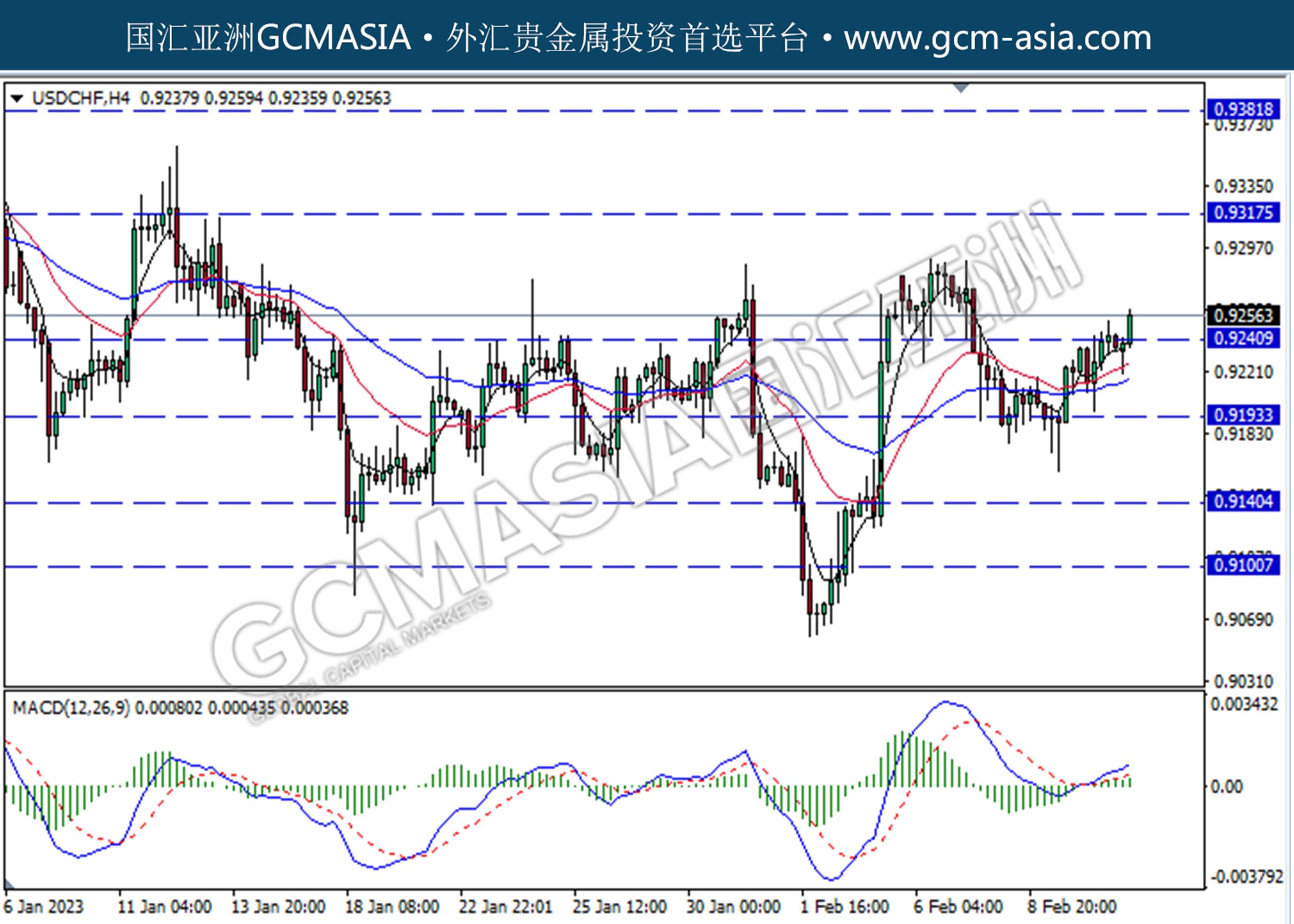

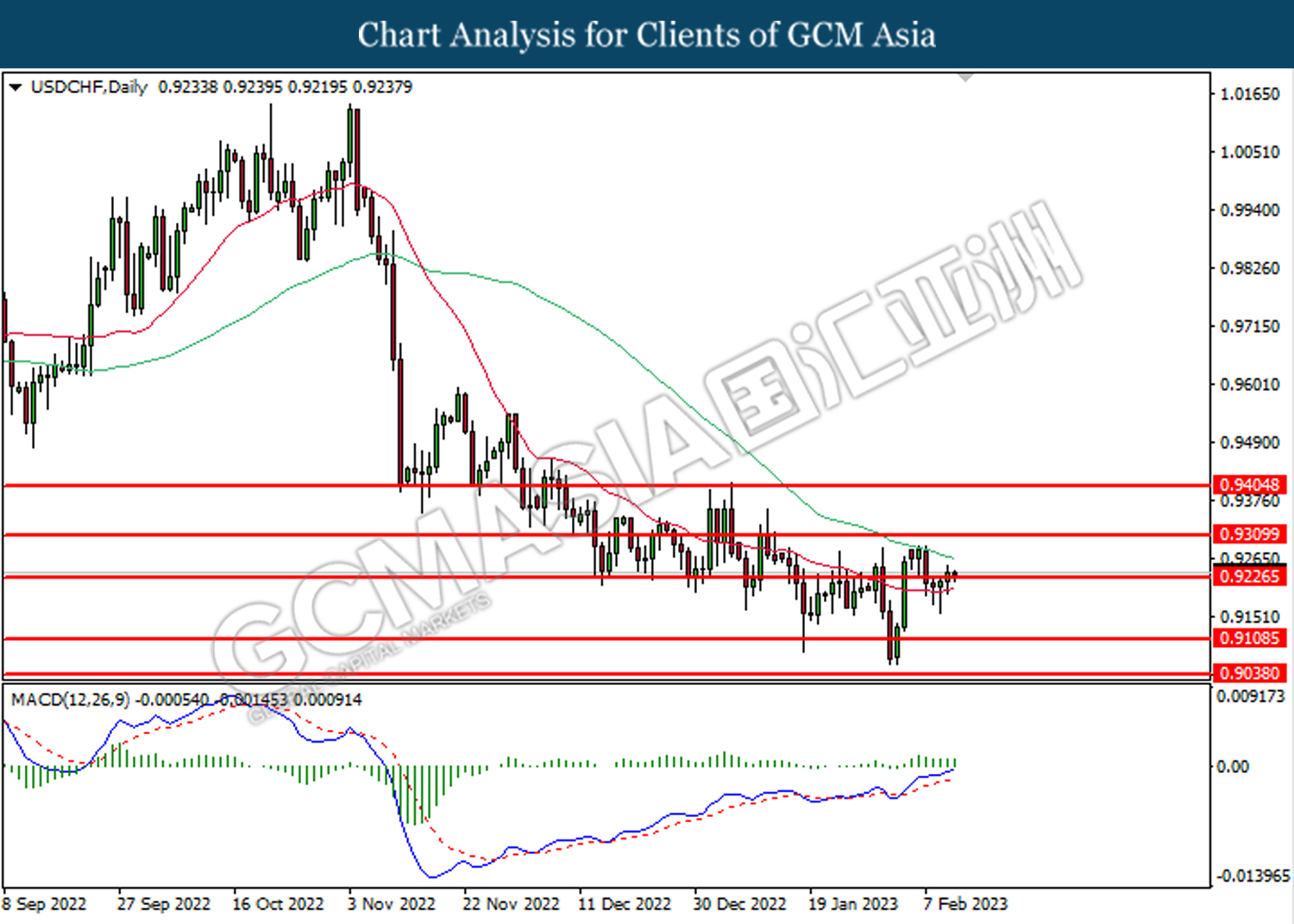

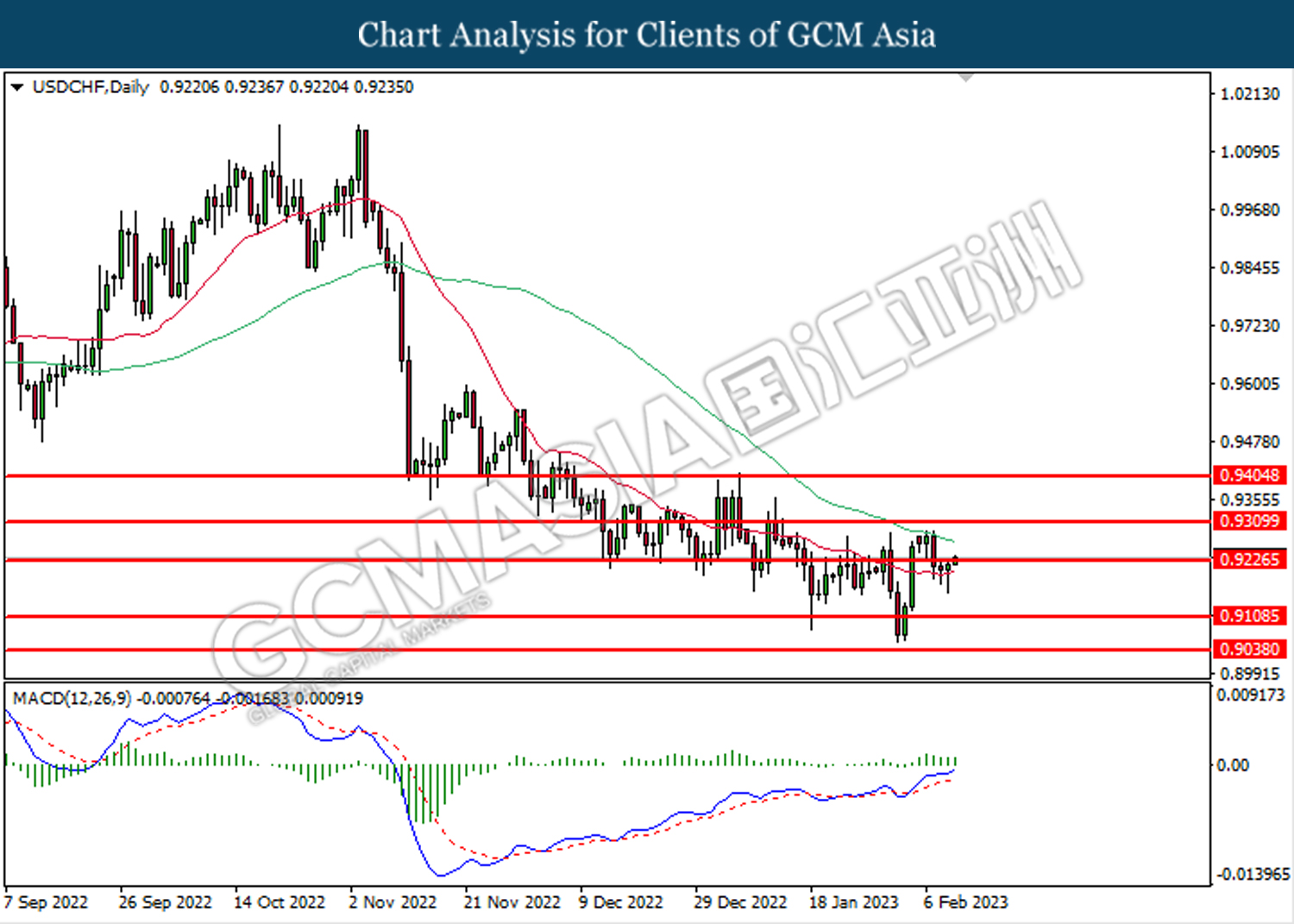

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9240. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains if successfully breakout above the resistance level.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

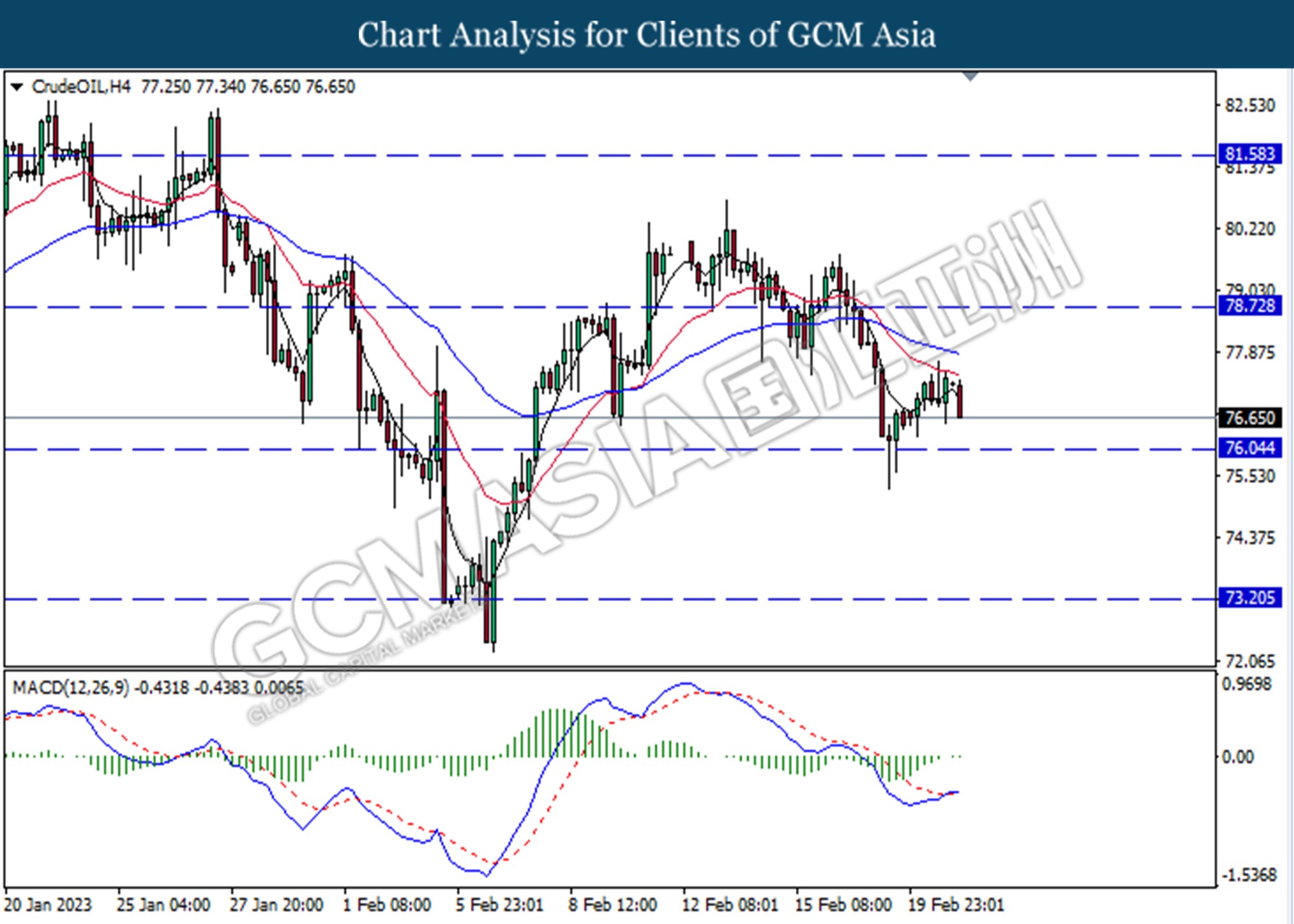

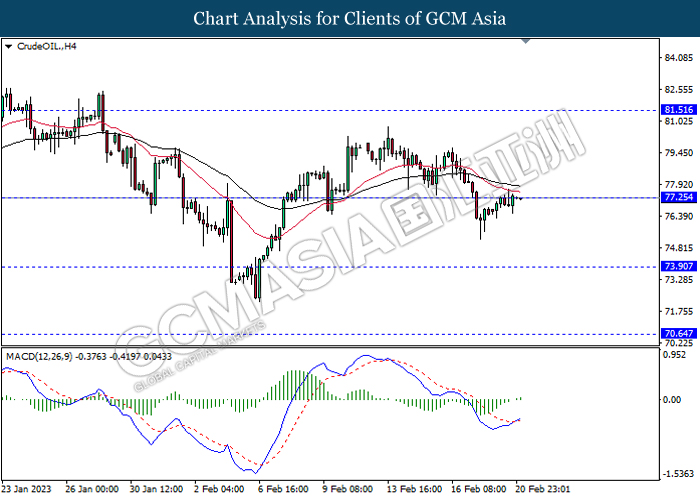

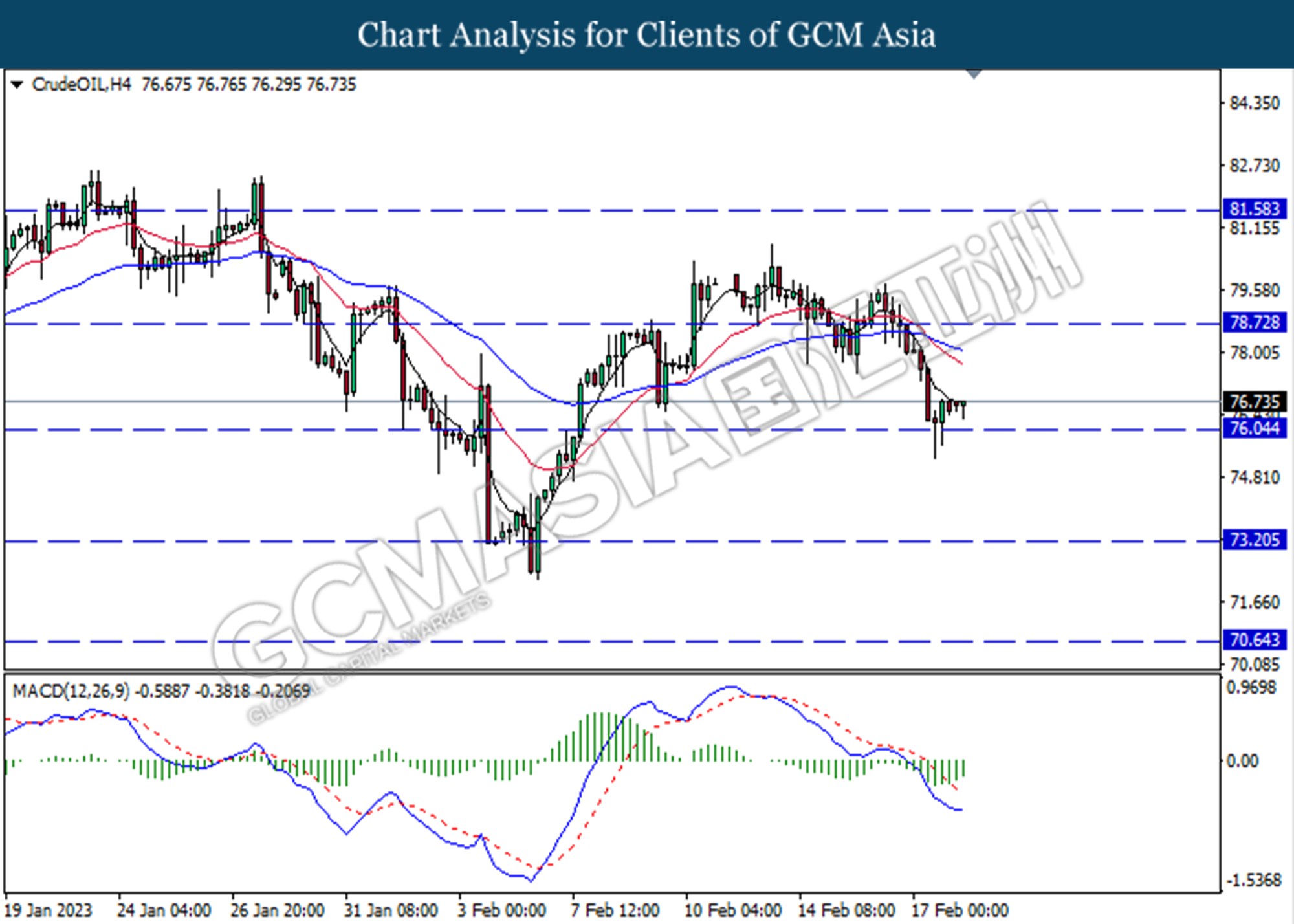

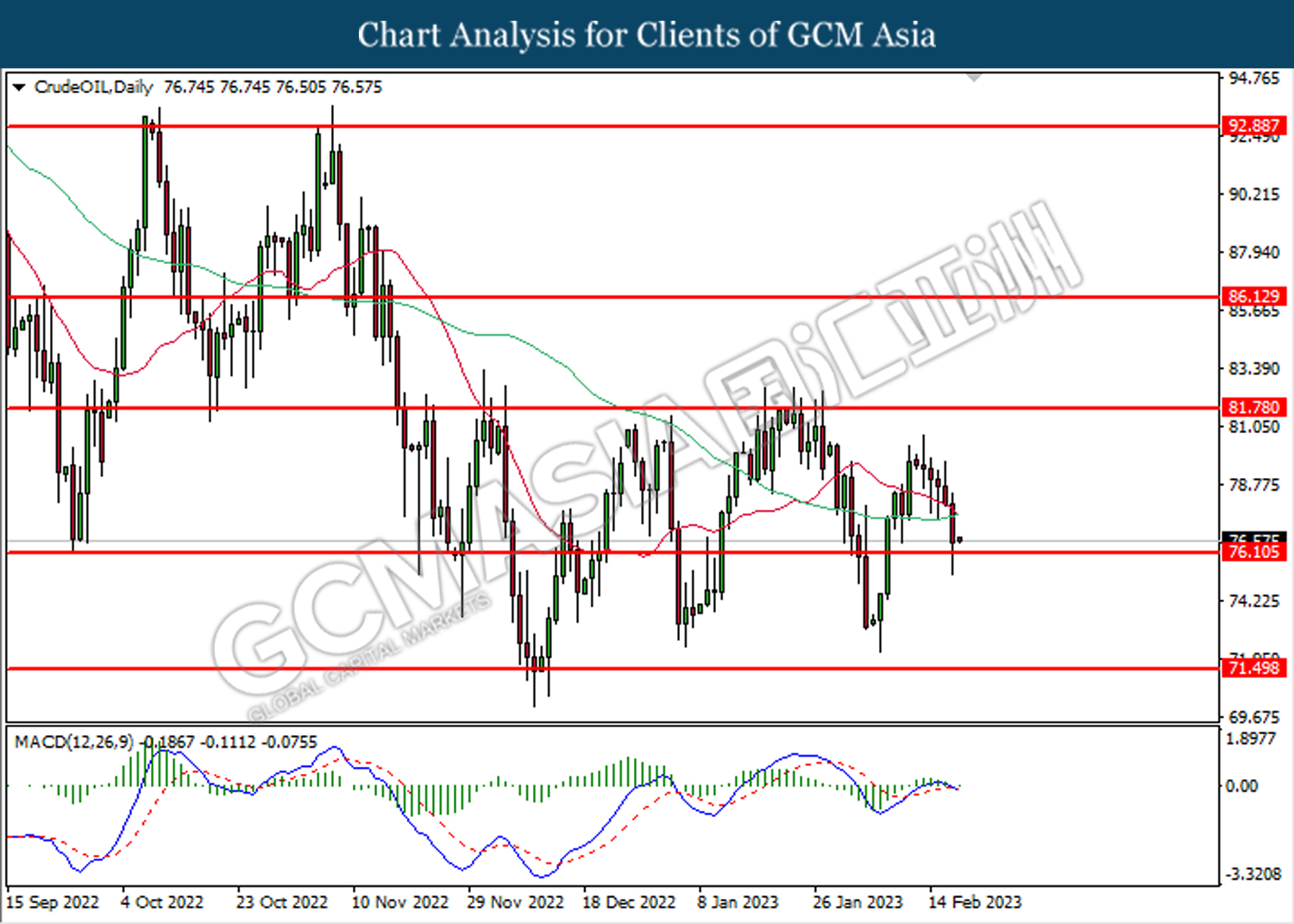

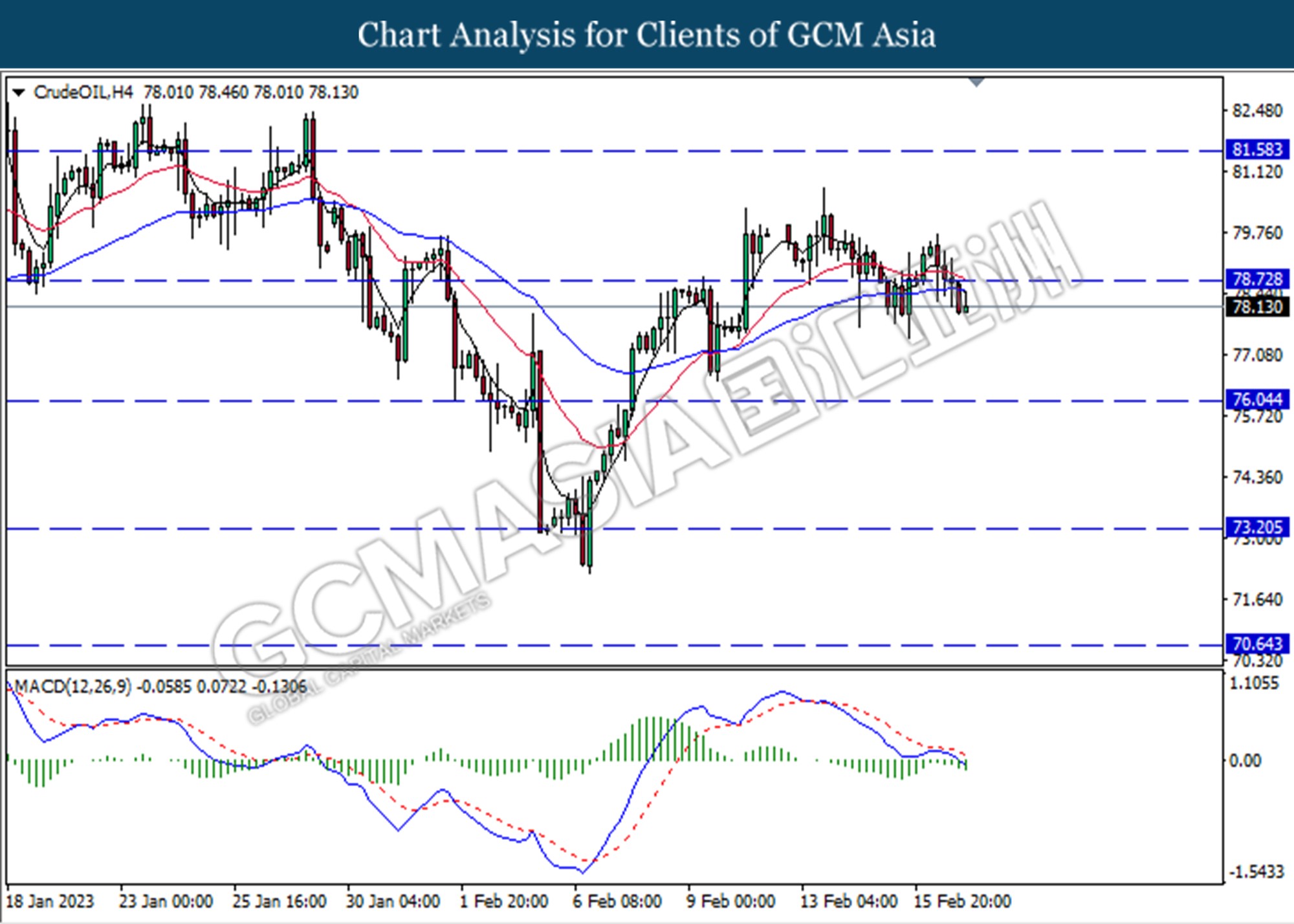

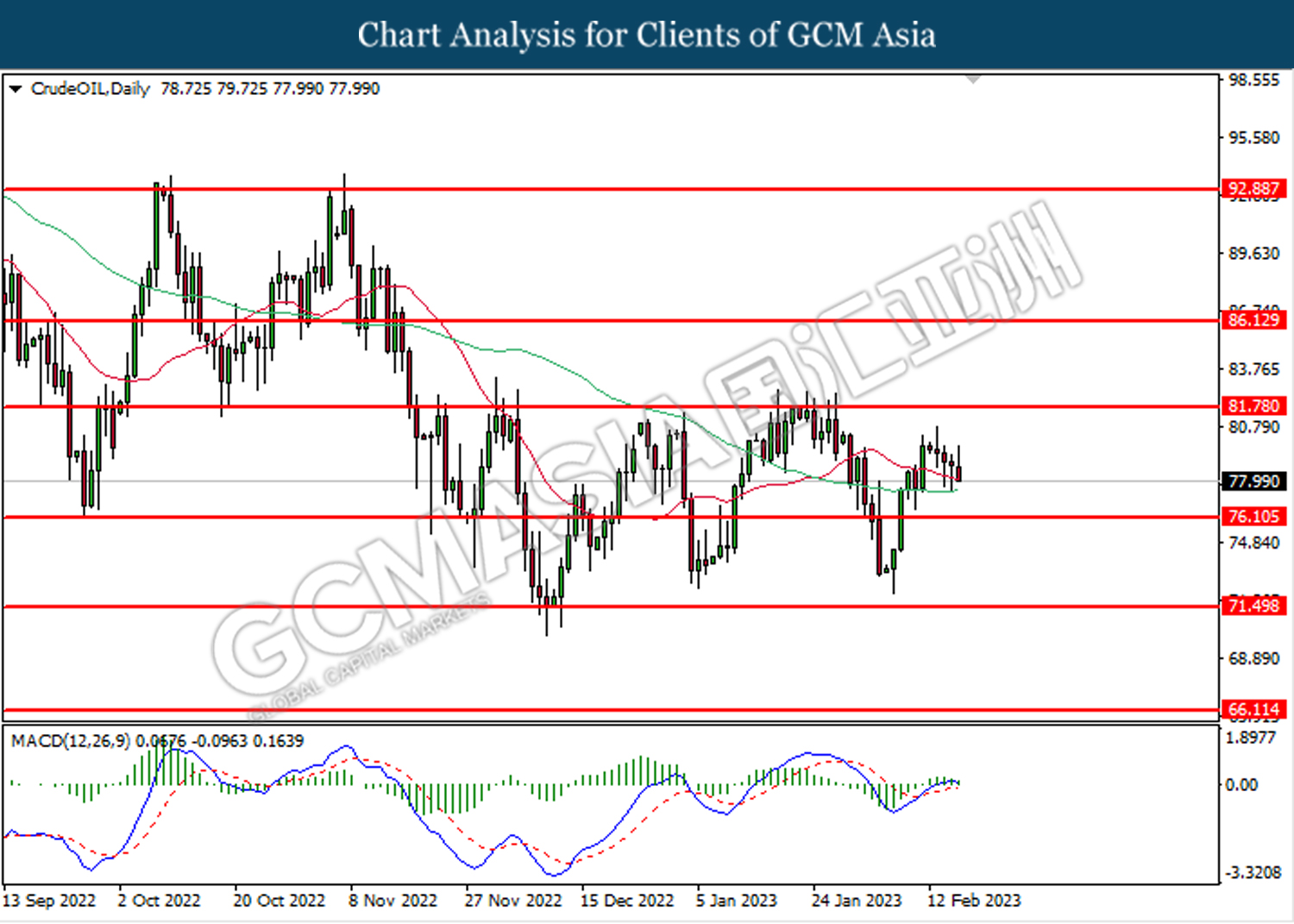

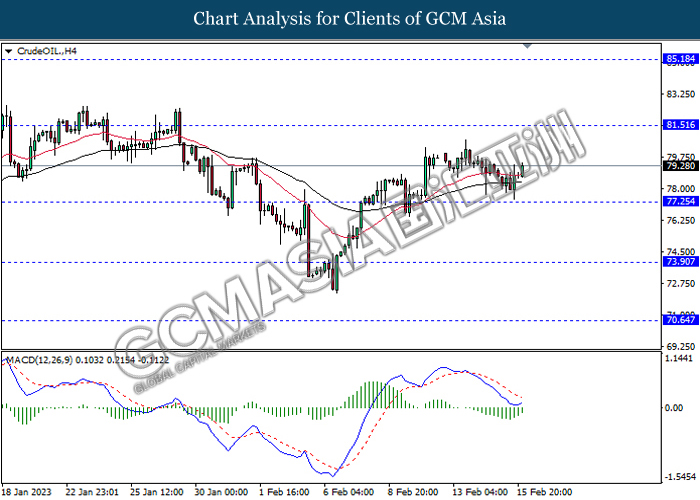

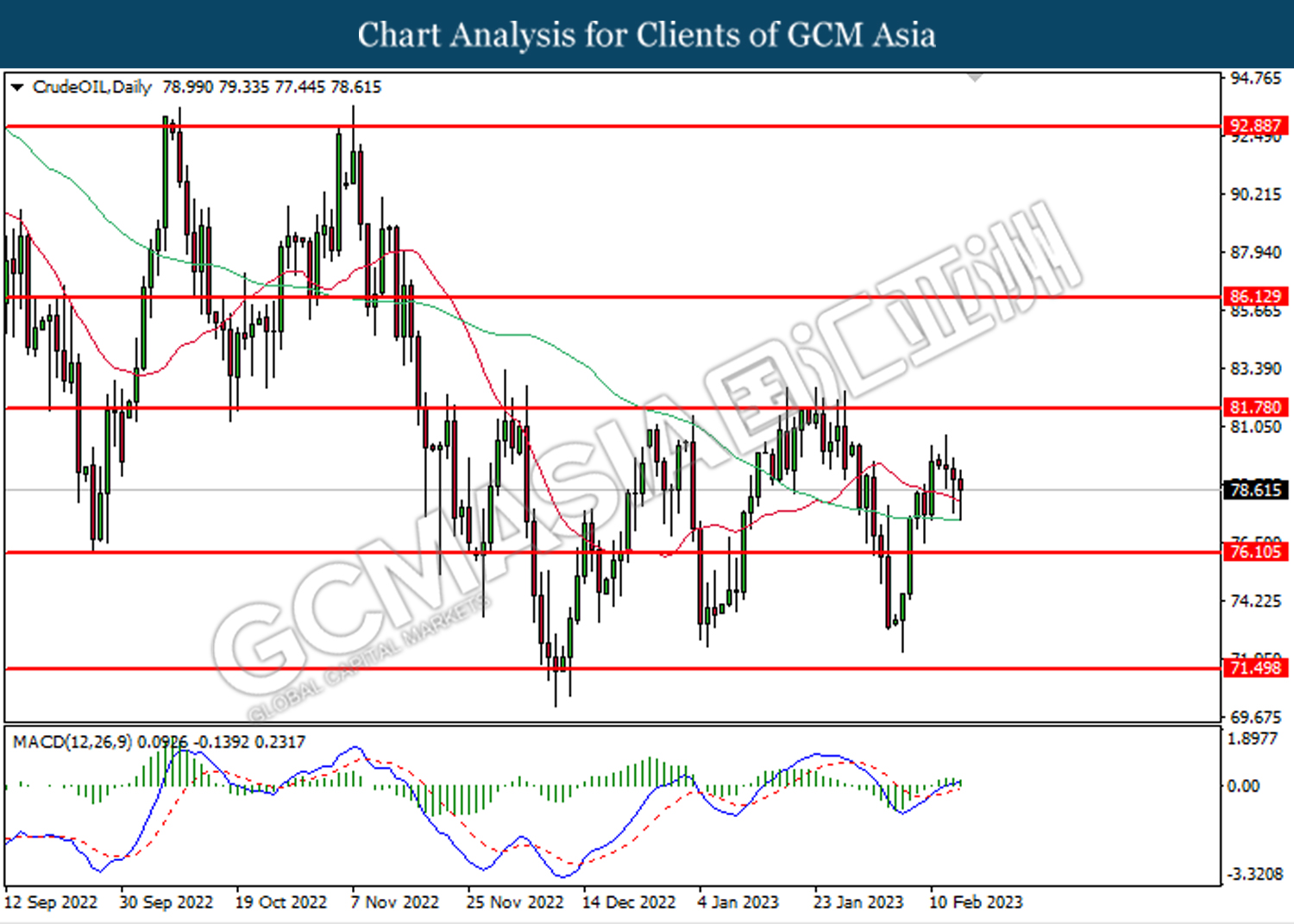

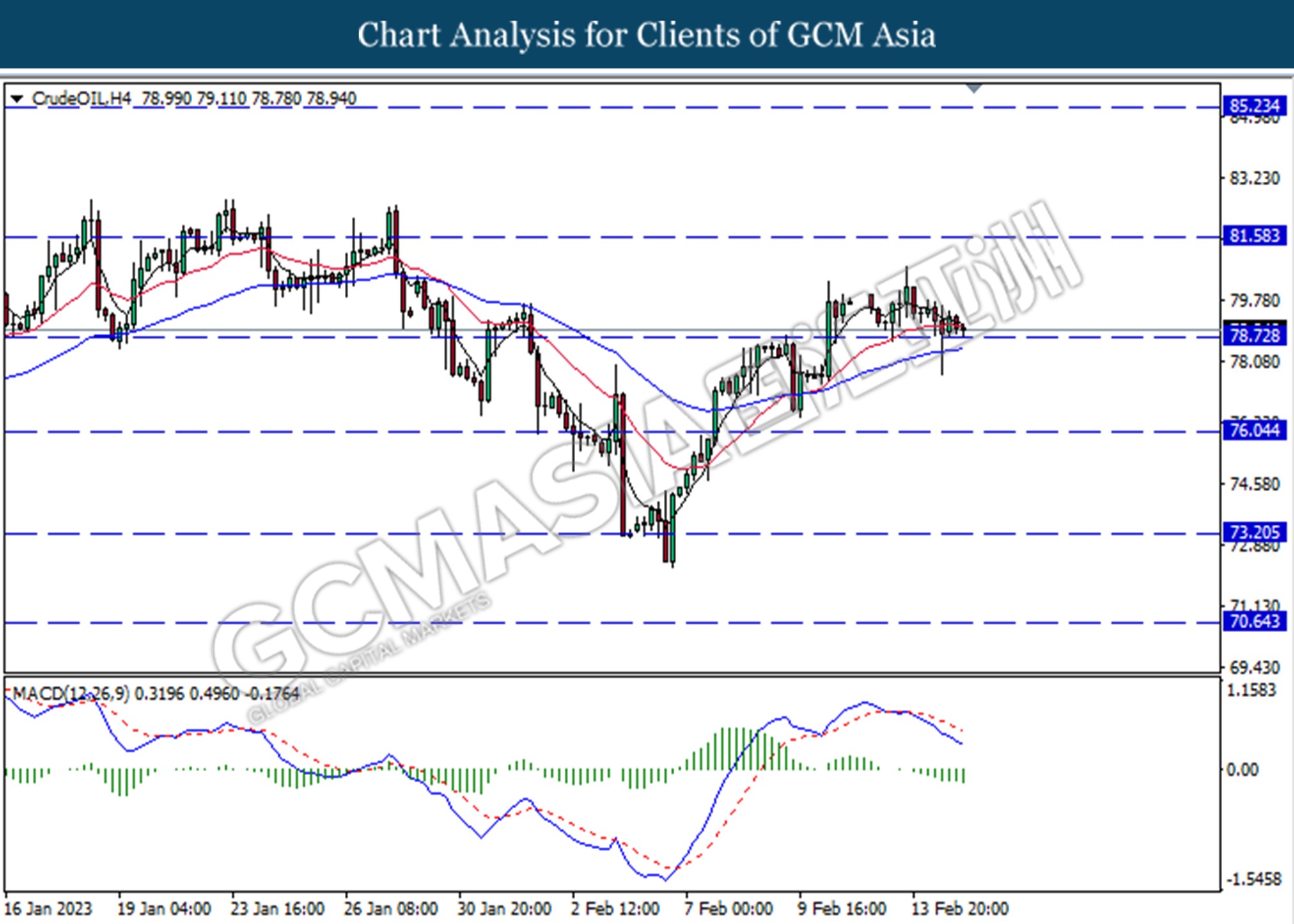

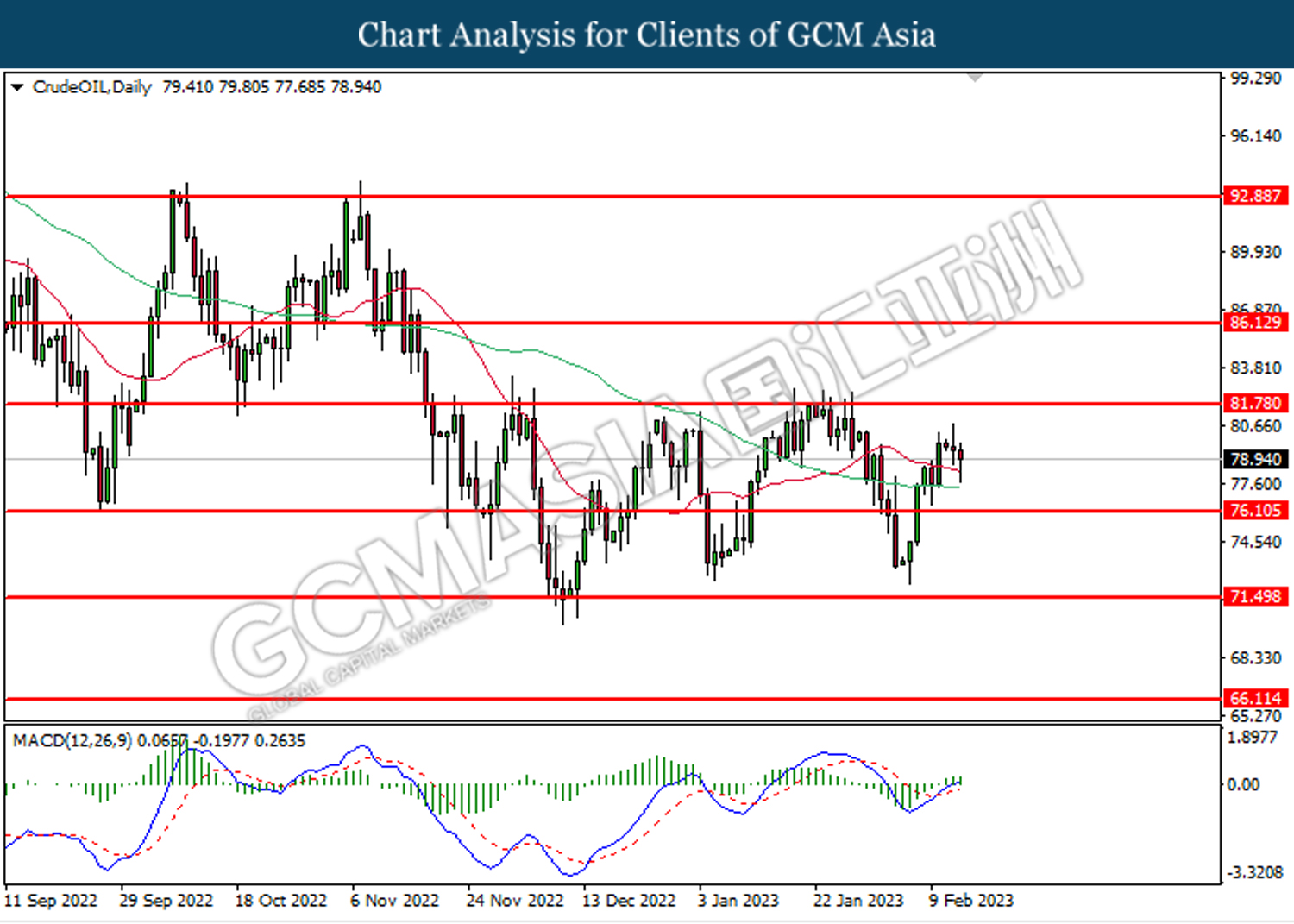

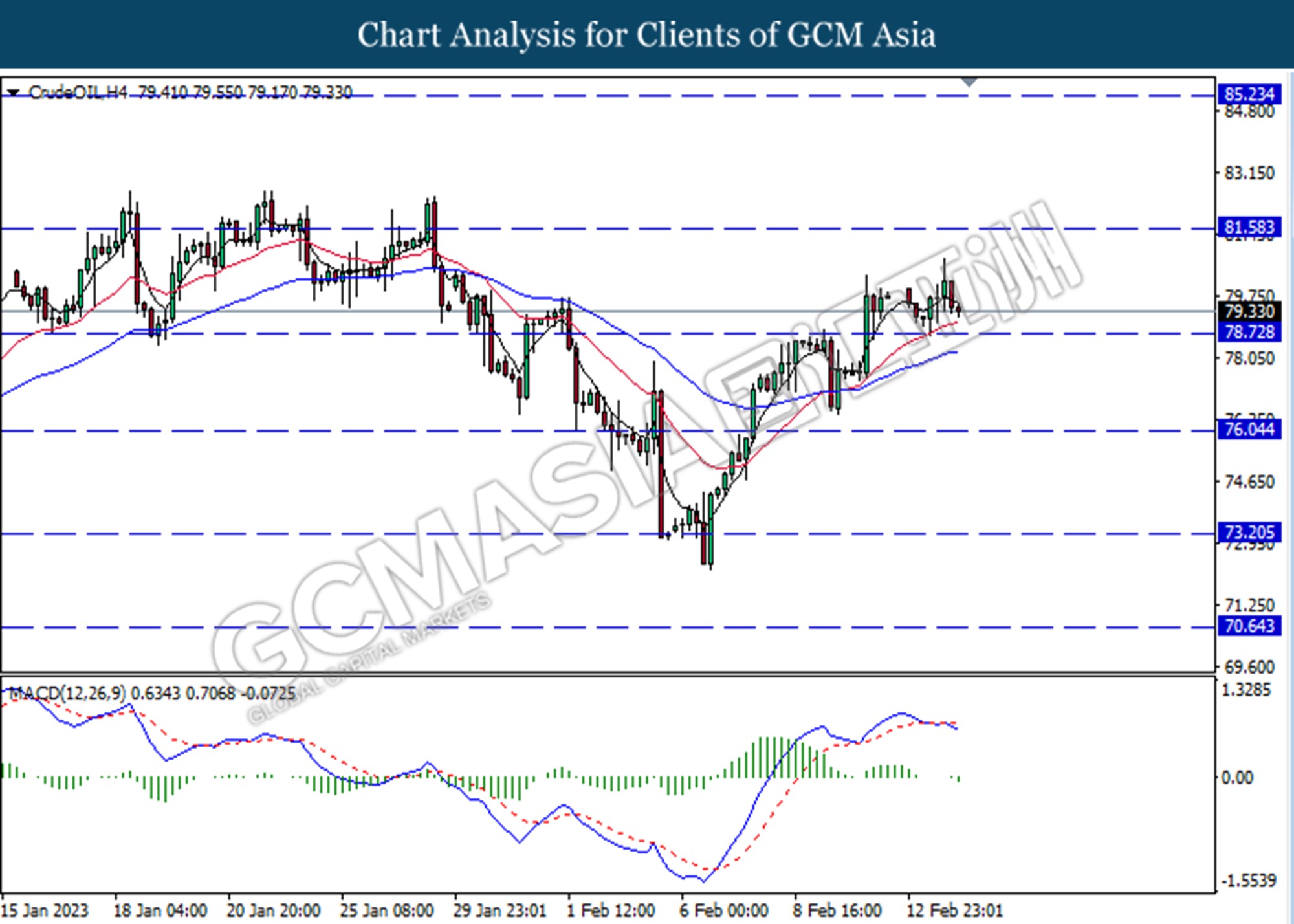

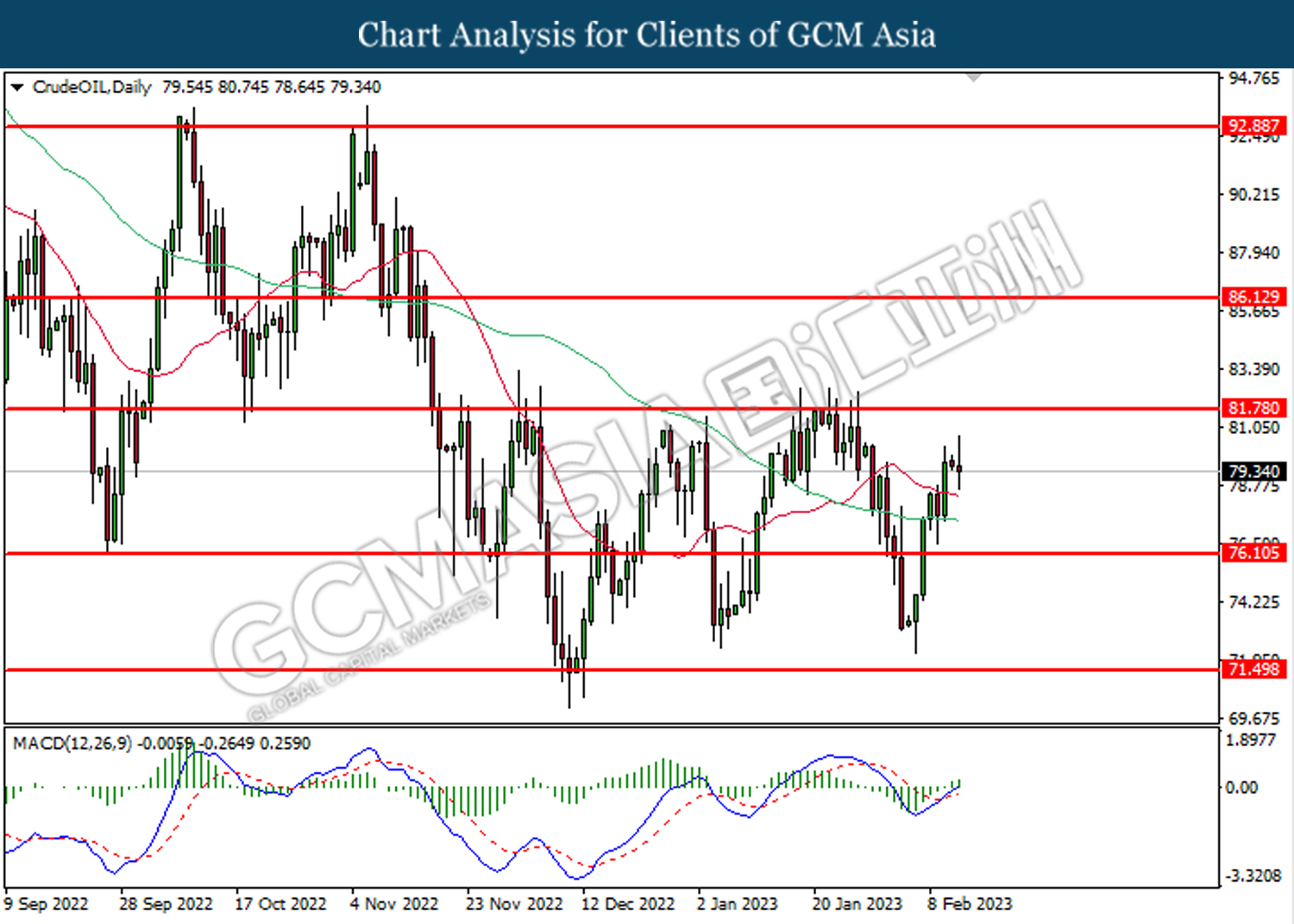

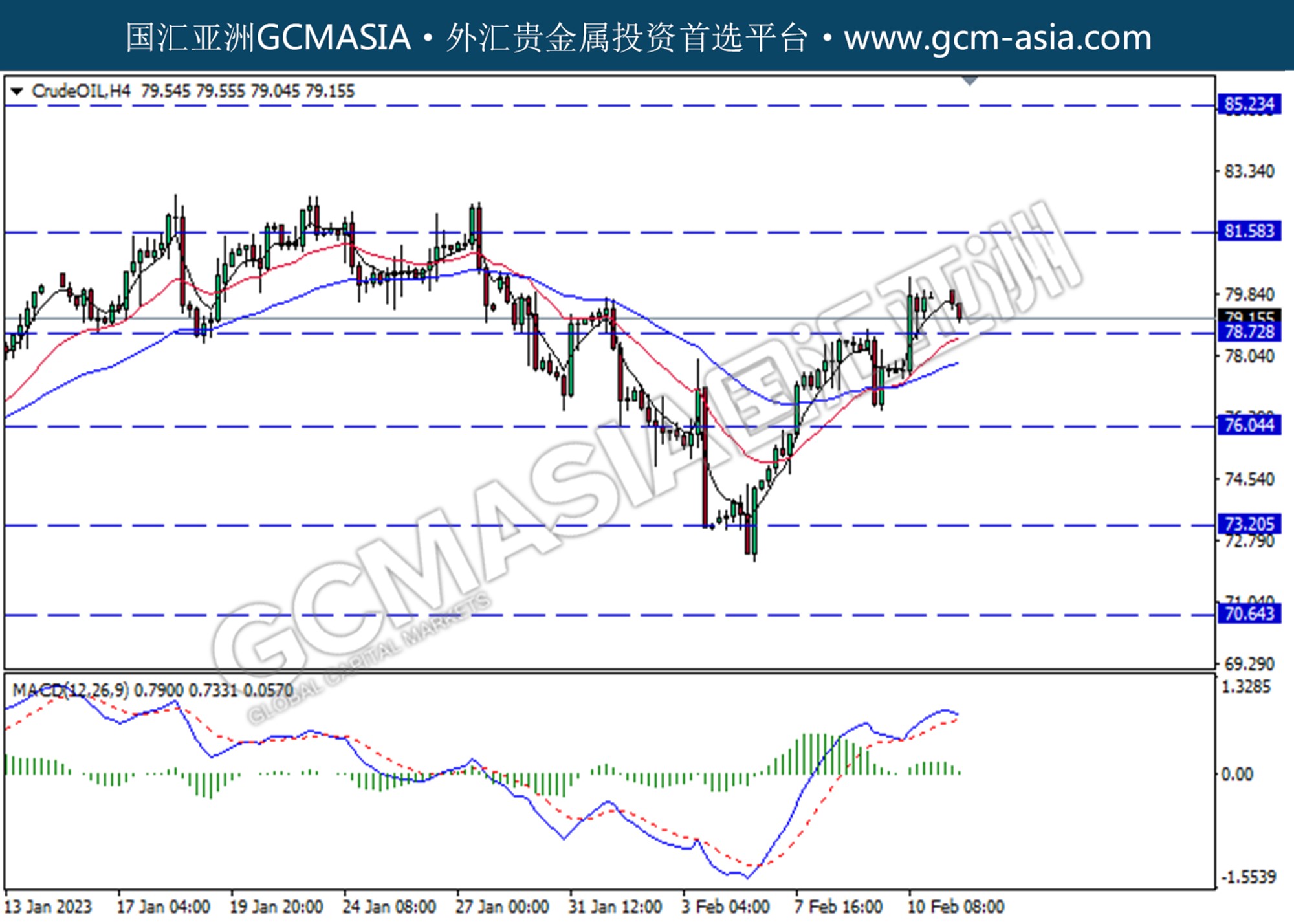

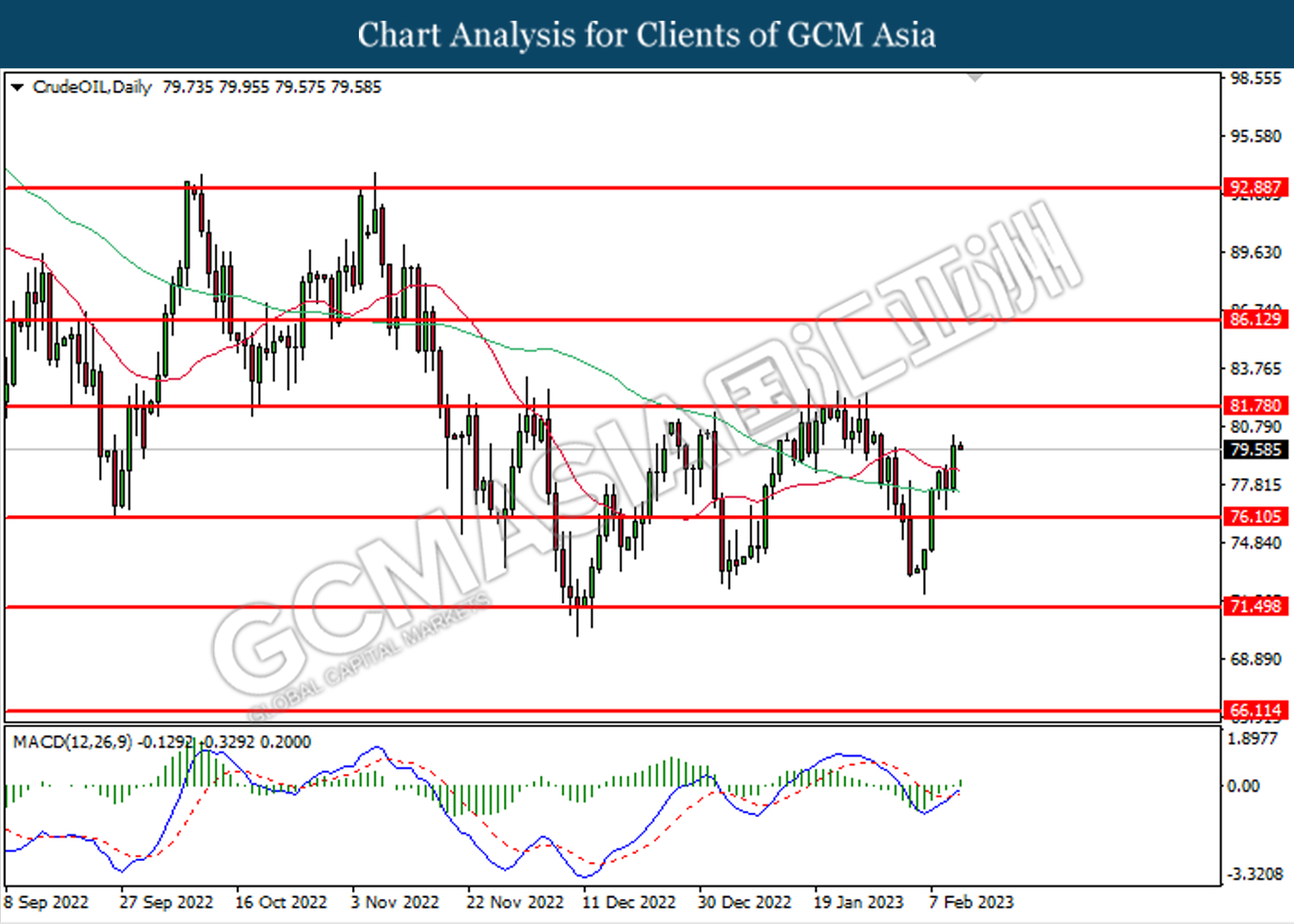

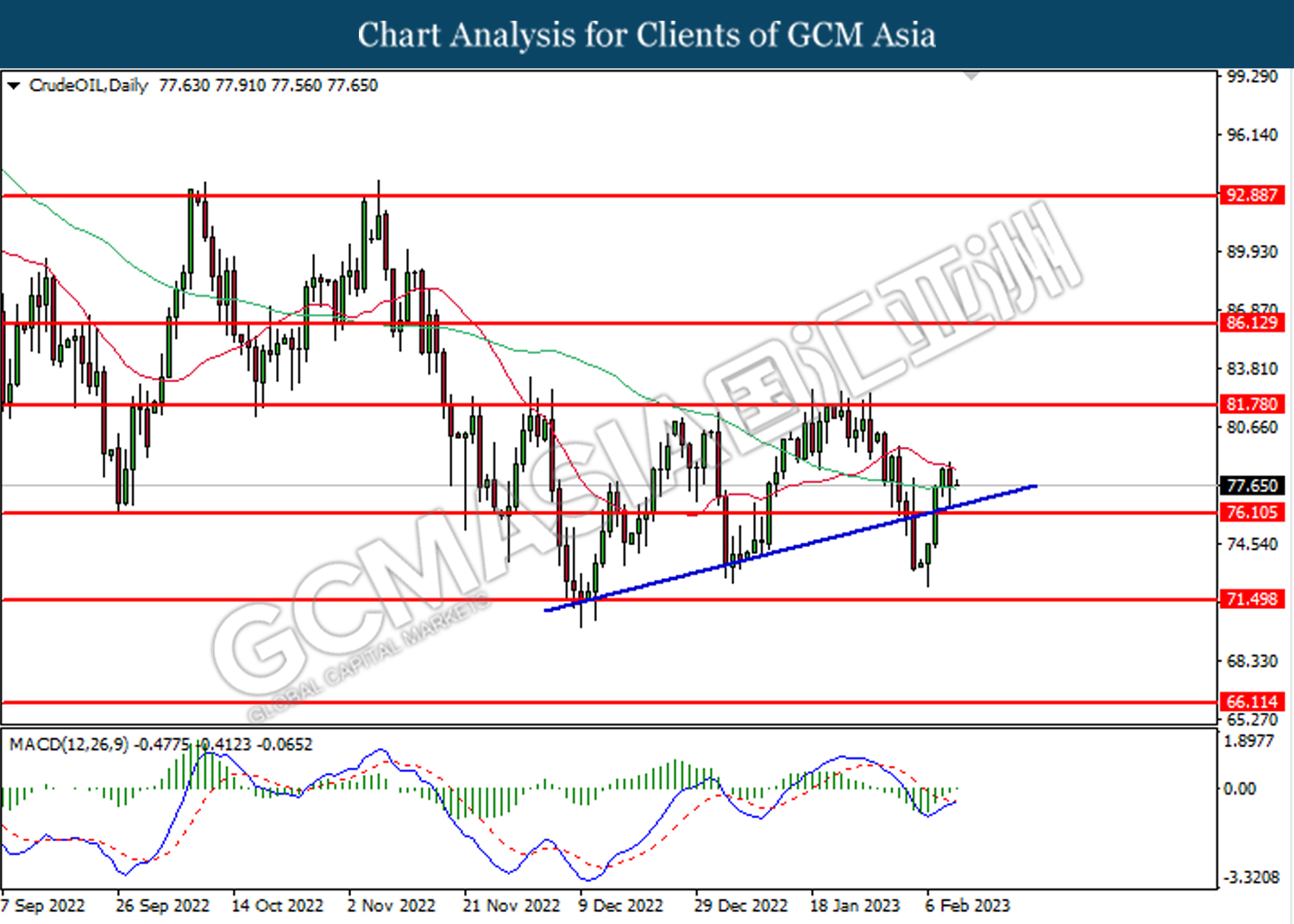

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 76.05.

Resistance level: 78.75, 81.60

Support level: 76.05, 73.20

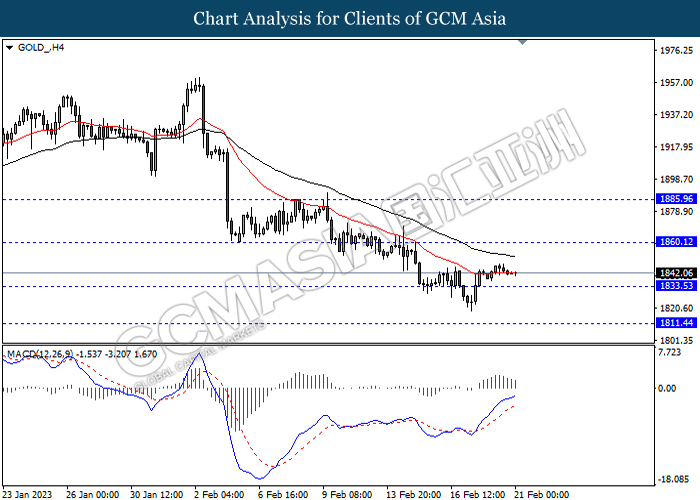

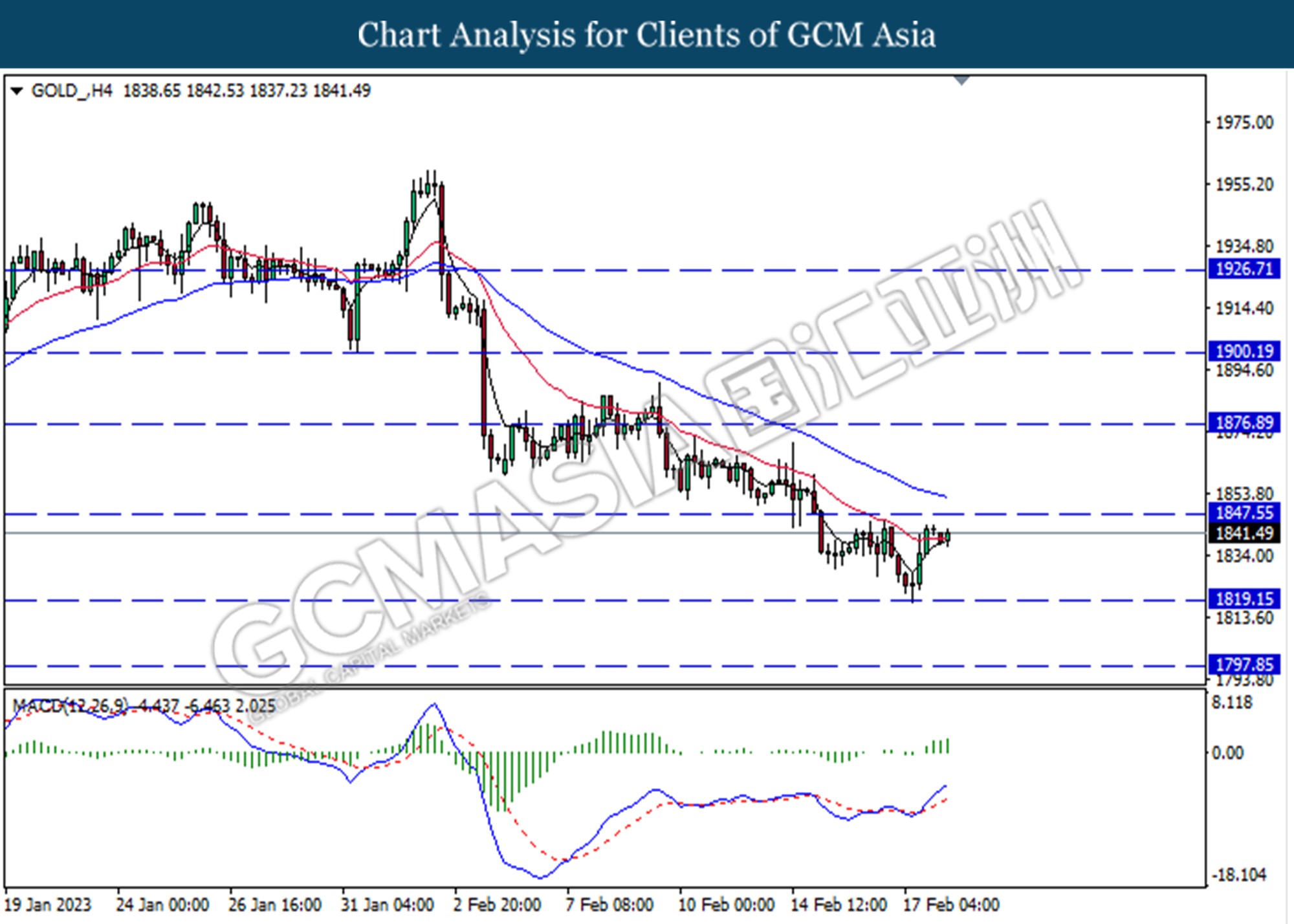

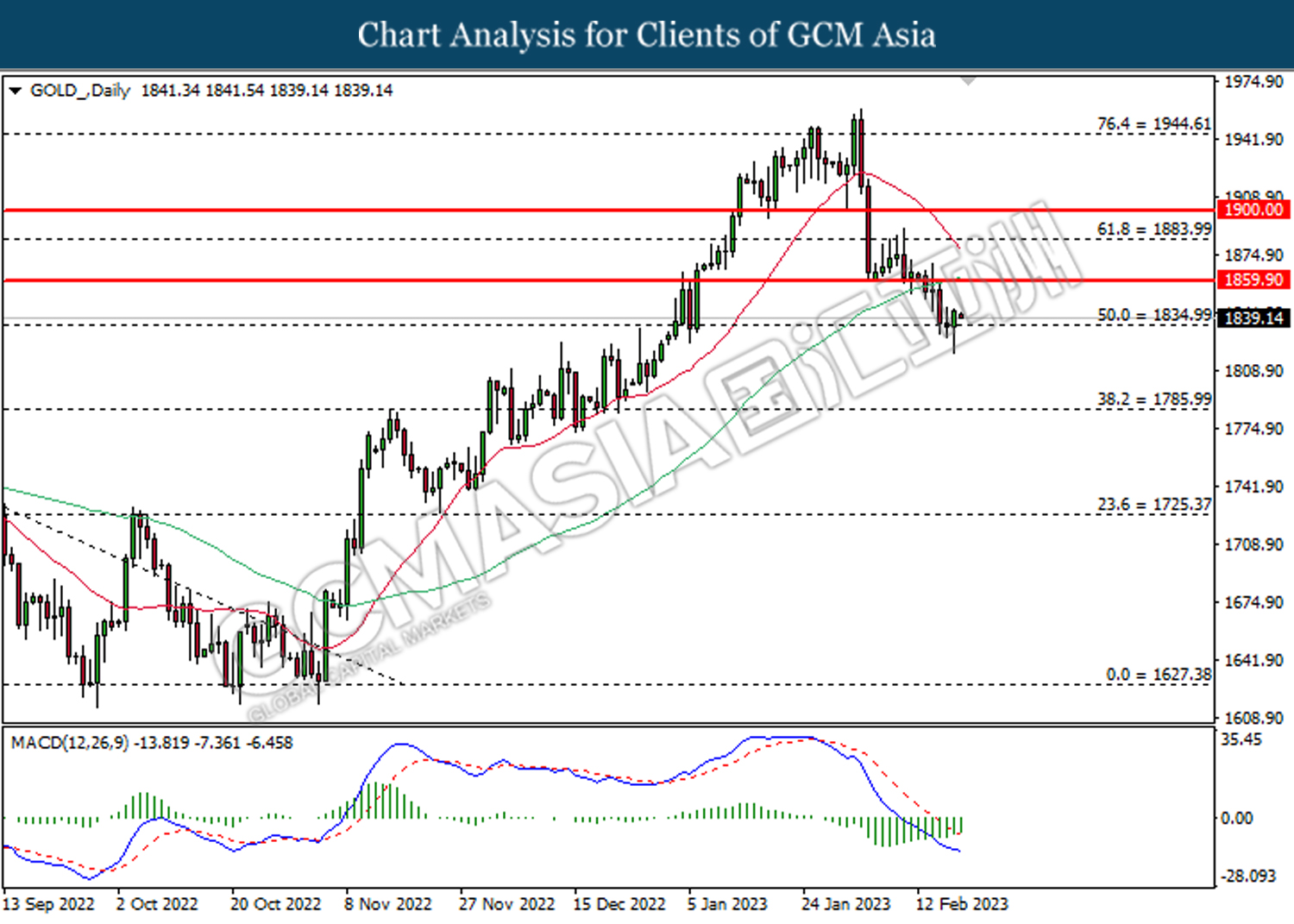

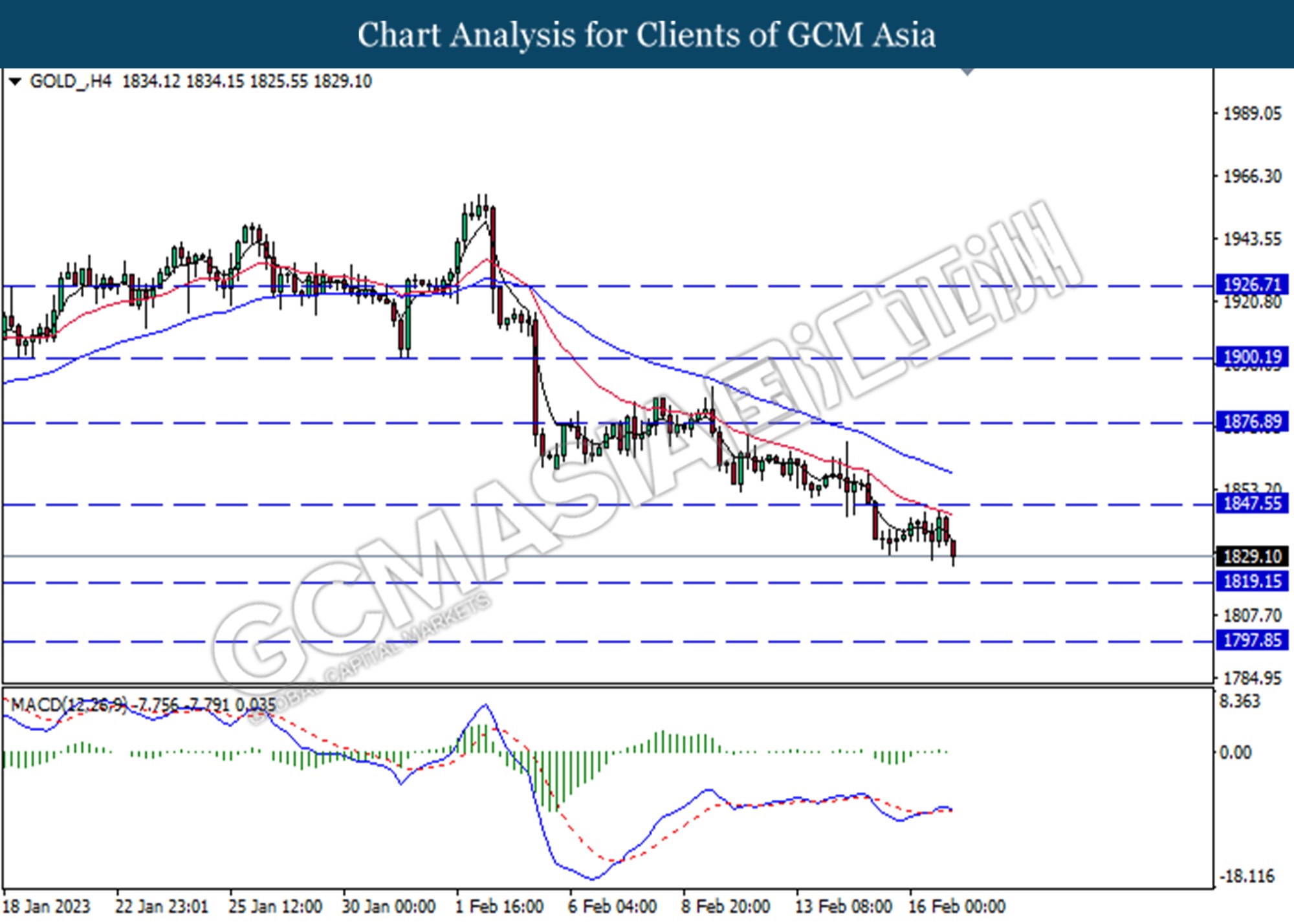

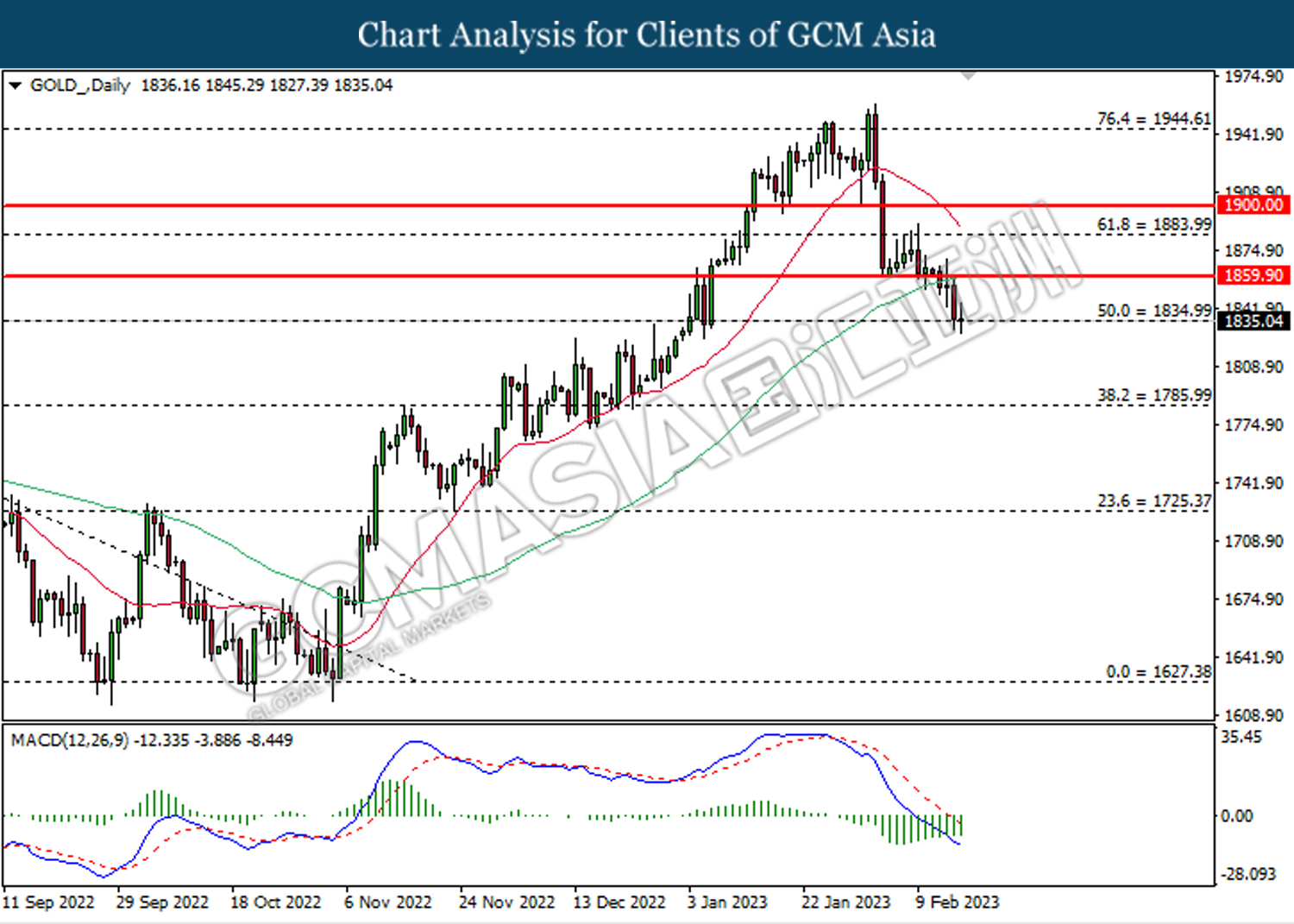

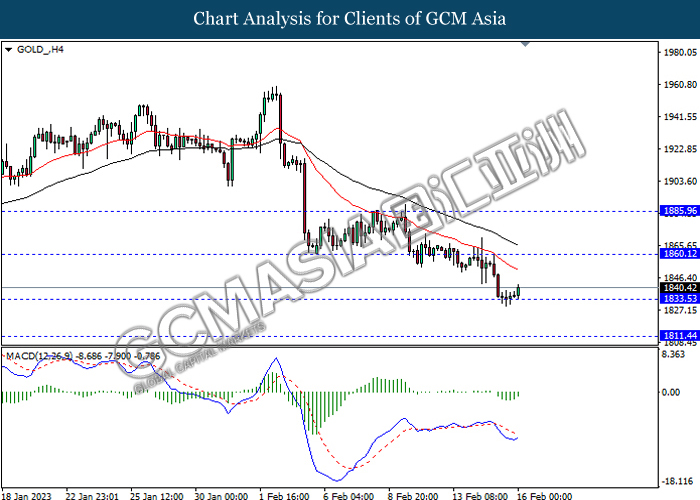

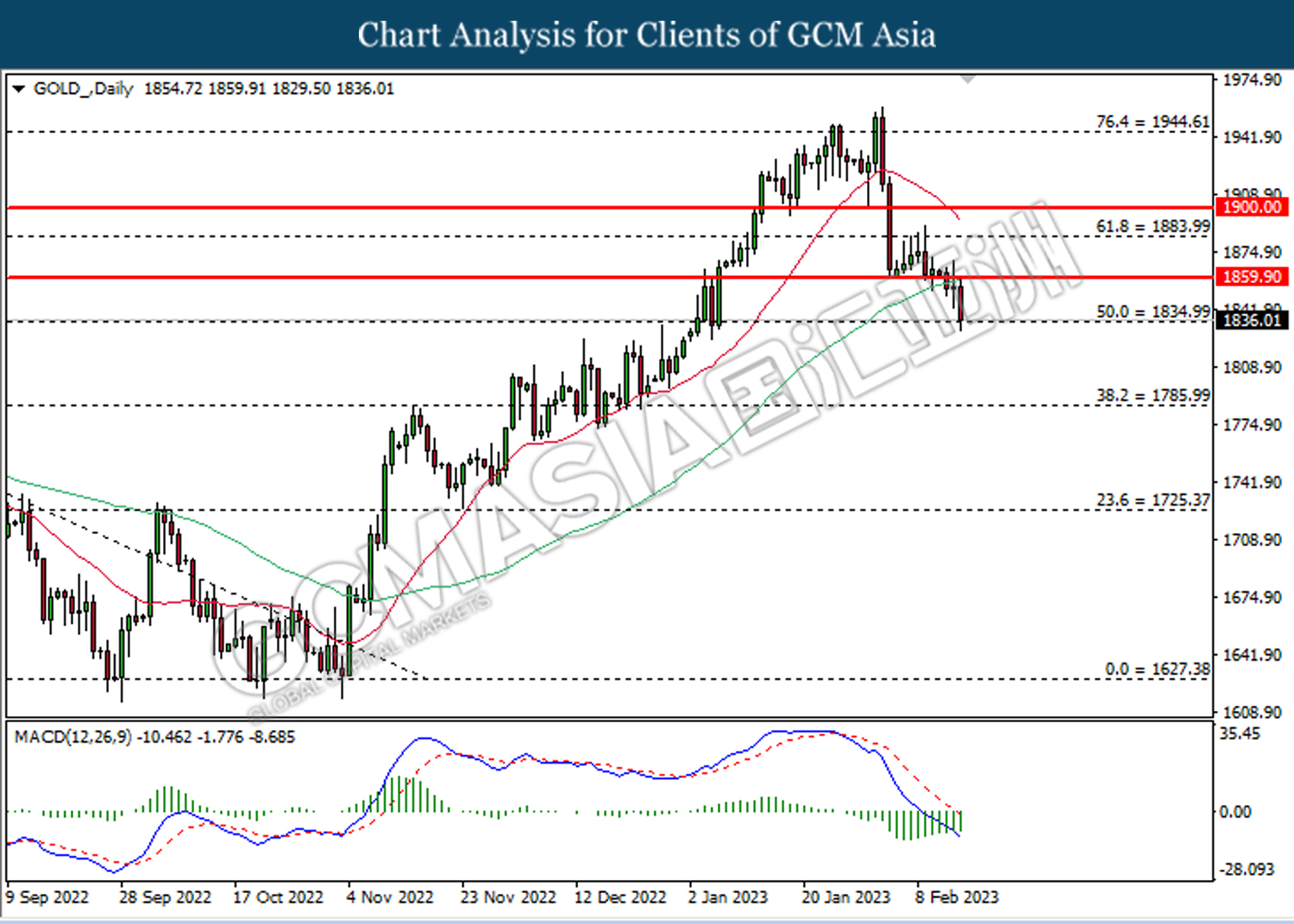

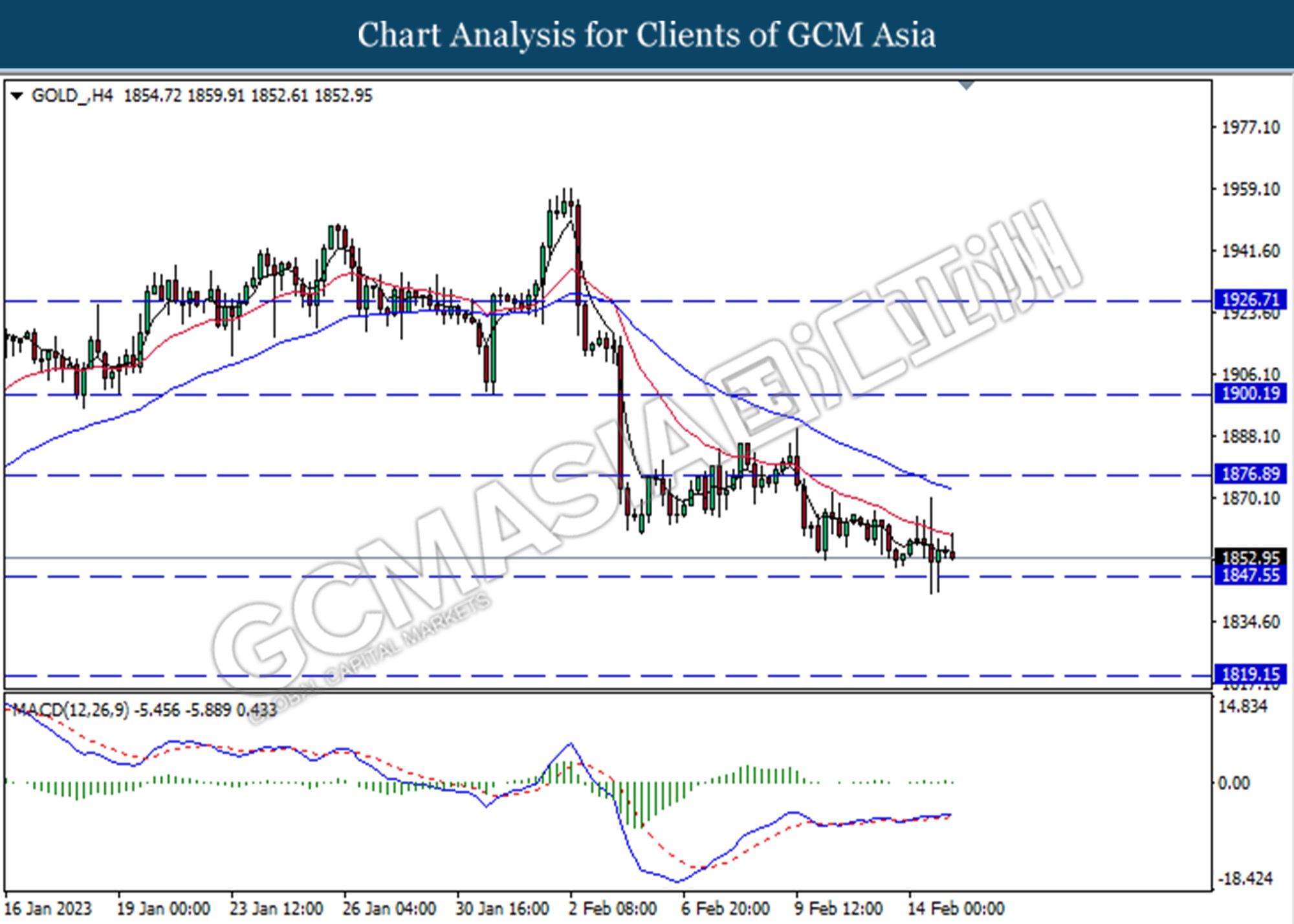

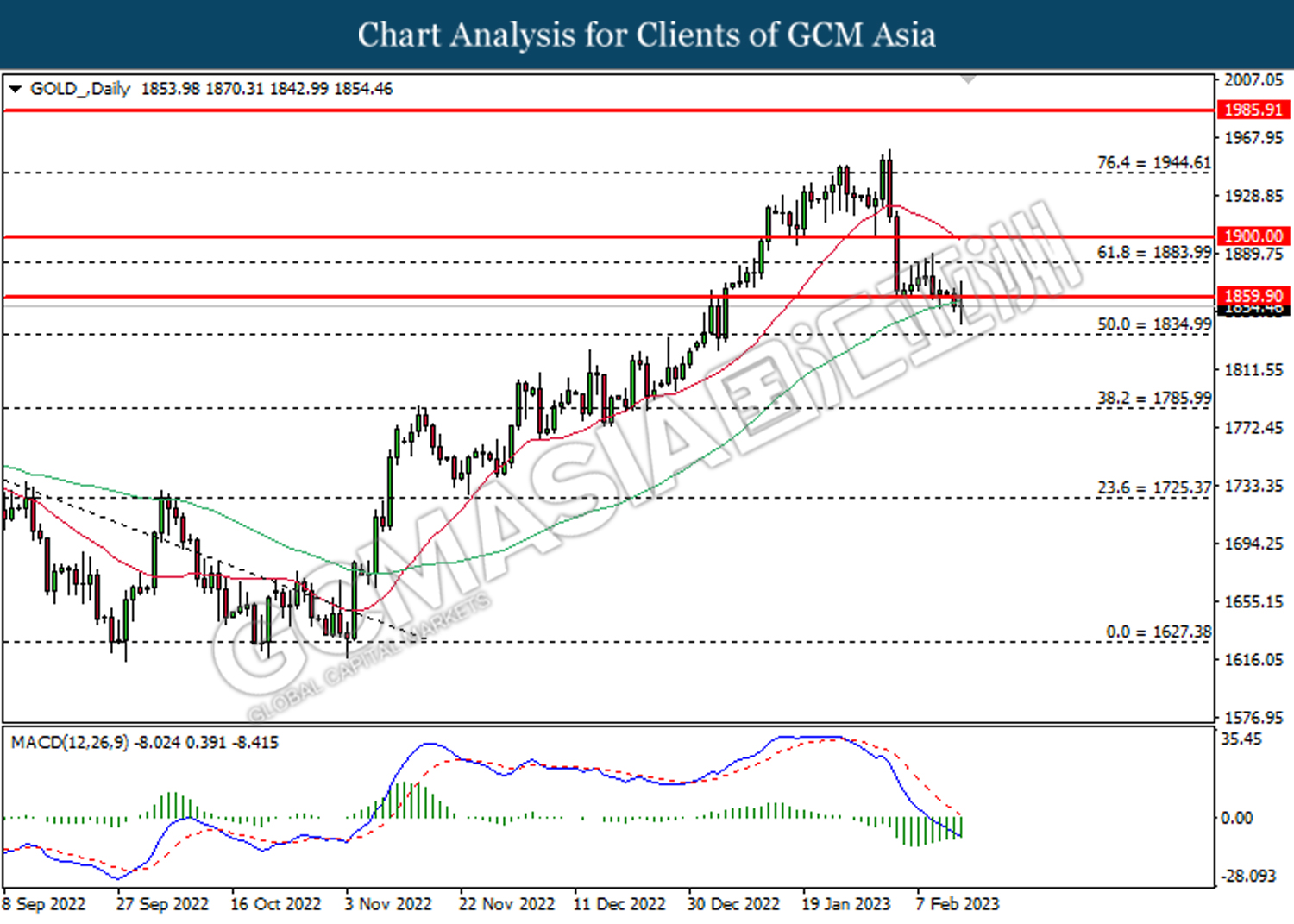

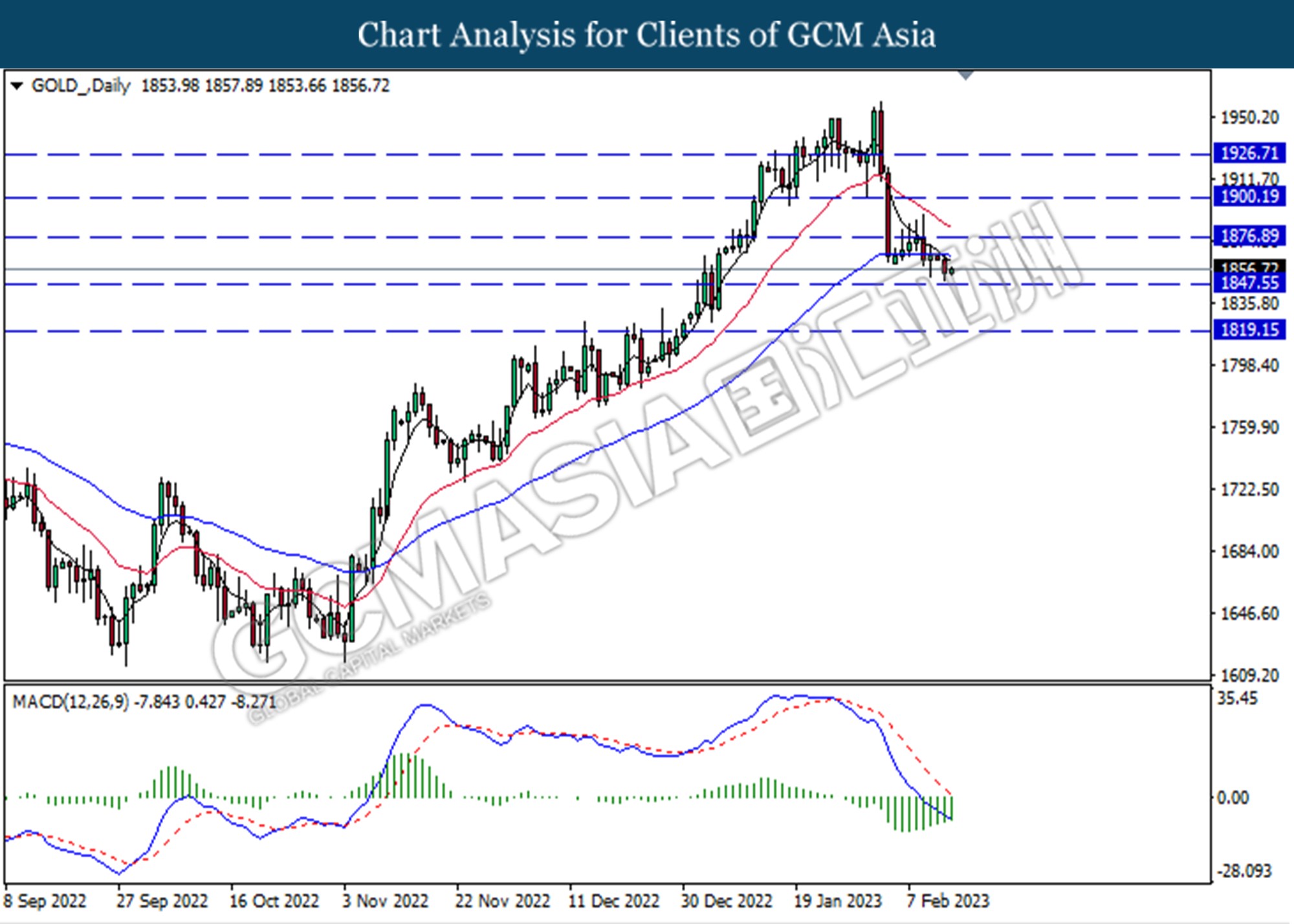

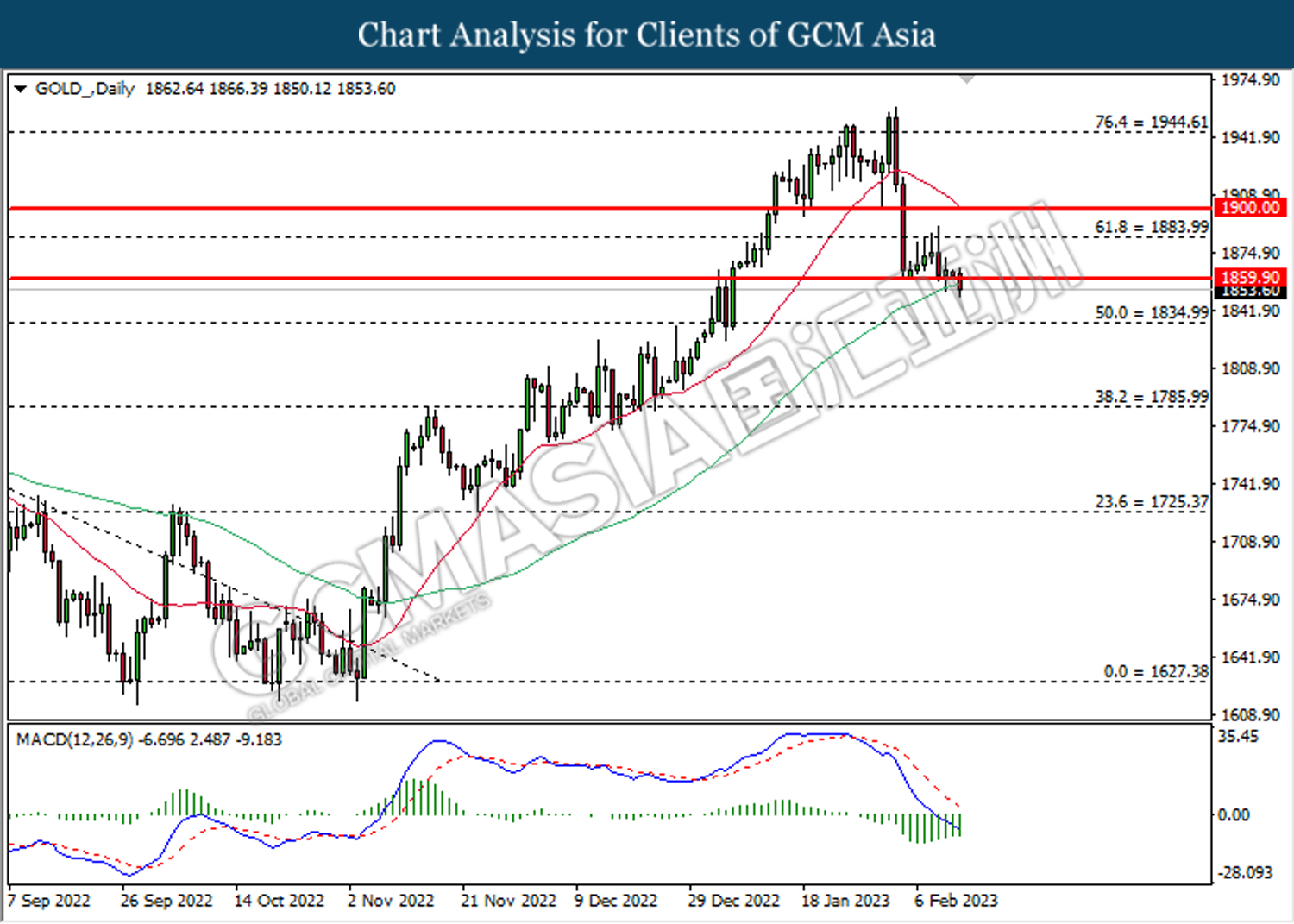

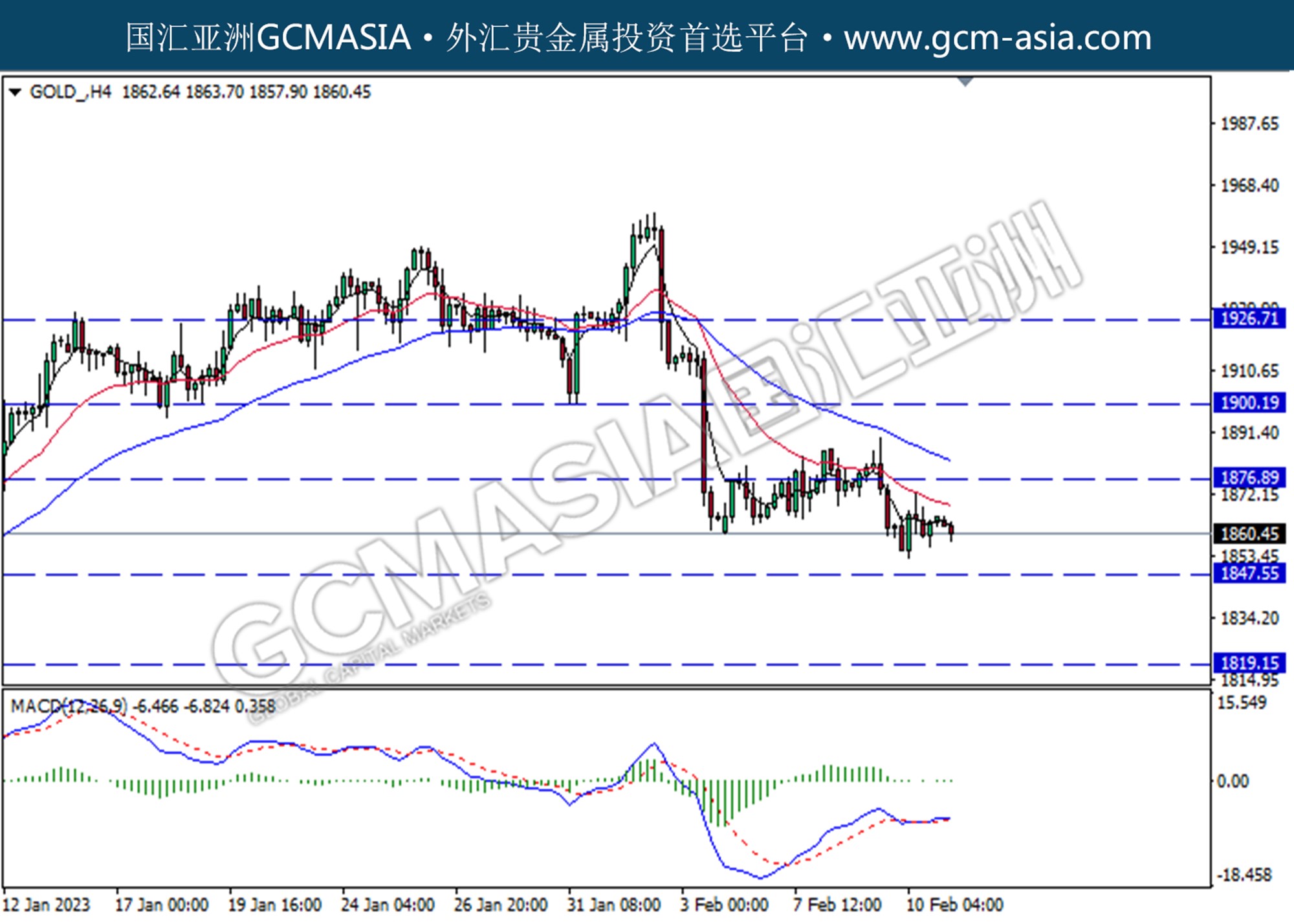

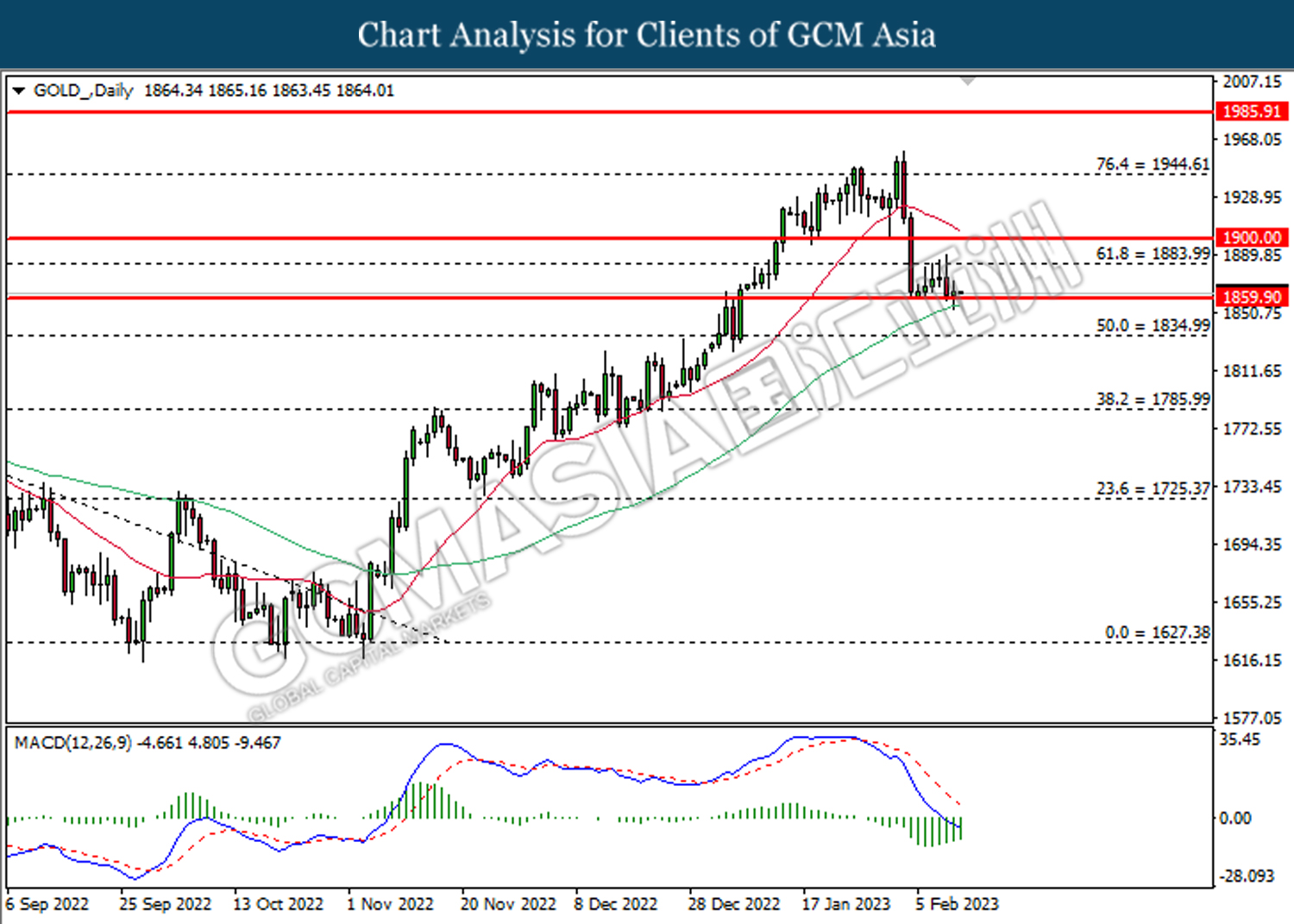

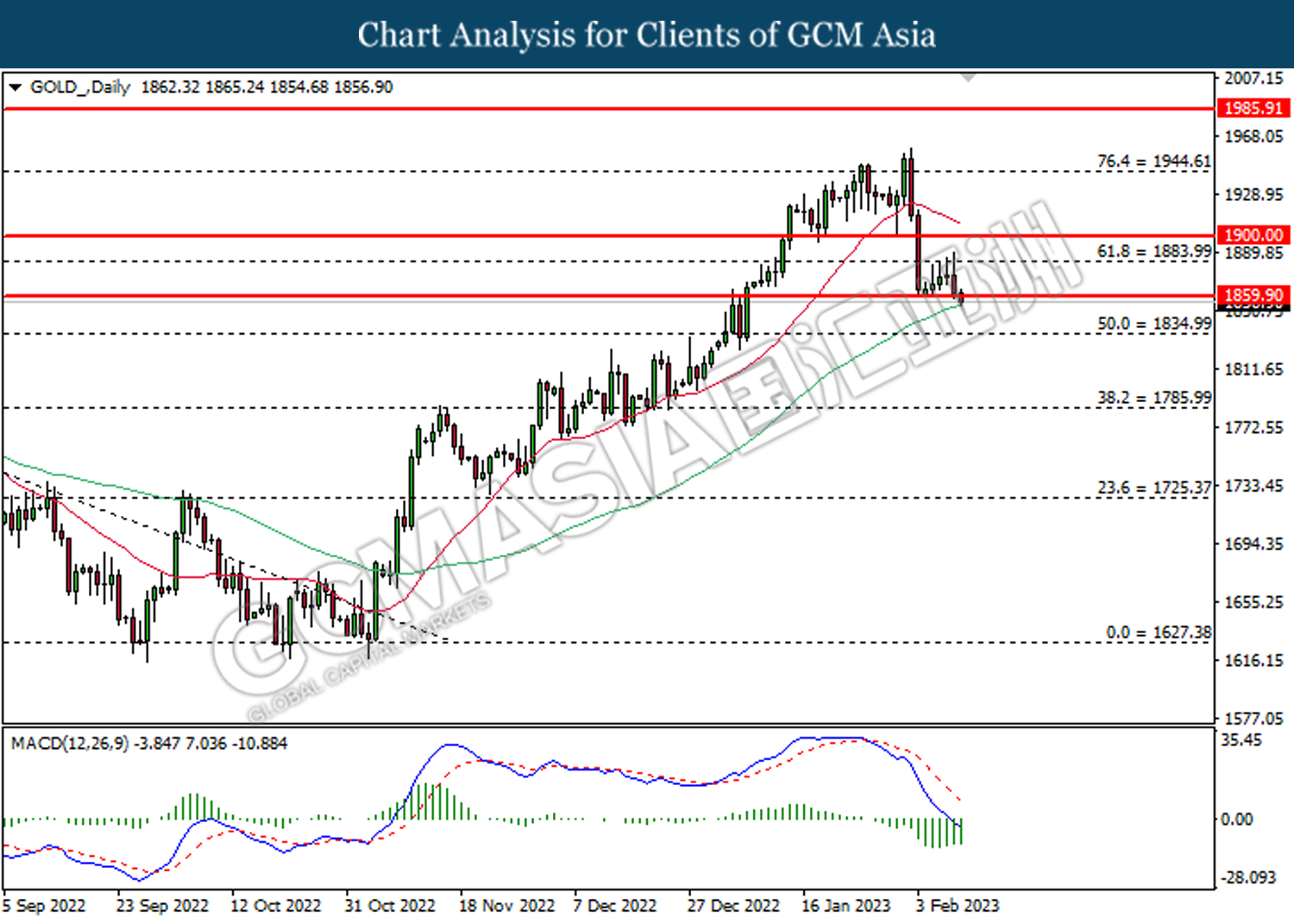

GOLD_, H4: Gold price was traded lower following a prior retracement from the resistance level at 1819.15. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45

210223 Morning Session Analysis

21 February 2023 Morning Session Analysis

Movement of US Dollar slowed as market was lack of catalyst.

The Dollar Index which traded against a basket of six major currencies seesawed on Monday amid the low trading volume, with the US market close for Washington President’s birthday. After that, however, investors would start to focus on several crucial data and events. Prior to that, a series of economic data from the US has out-performed market expectation, which indicating that the US economy was not entering recession yet despite the aggressive rate hike implementation. On the other hand, the hawkish statement from Fed officials signaled there are still a long way to curb inflation, as well as the central bank has been suggested to raise further interest rate. Thus, the event and economic data such as FOMC Meeting Minutes, GDP and Core PCE Price Index would gather the attention of market participants. In addition, investors would continue to scrutinize the latest update with regards of Russia-Ukraine tensions. According to CNBC, the US President Joe Biden was meeting with Ukraine President Volodymyr Zelenskyy to reaffirm unwavering and unflagging commitment to Ukraine’s democracy, sovereignty, and territorial integrity. As of writing, the Dollar Index edged up by 0.01% to 103.78.

In the commodity market, the crude oil price depreciated by 0.14% to $77.27 per barrel as of writing following the rising concerns of hefty rate hike by Fed officials, which might lead a recession in the US. Besides that, the gold price dropped by 0.03% to $1840.72 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 47.3 | 47.8 | – |

| 17:30 | GBP – Composite PMI | 48.5 | – | – |

| 17:30 | GBP – Manufacturing PMI | 47.0 | 47.5 | – |

| 17:30 | GBP – Services PMI | 48.7 | 49.2 | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 16.9 | 22.0 | – |

| 21:30 | CAD – Core CPI (MoM) (Jan) | -0.3% | 0.2% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | -0.6% | -0.1% | – |

| 23:00 | USD – Existing Home Sales (Jan) | 4.02M | 4.10M | – |

Technical Analysis

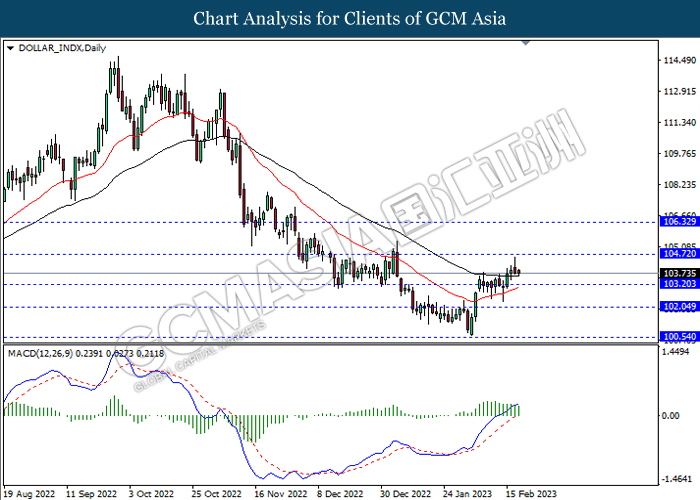

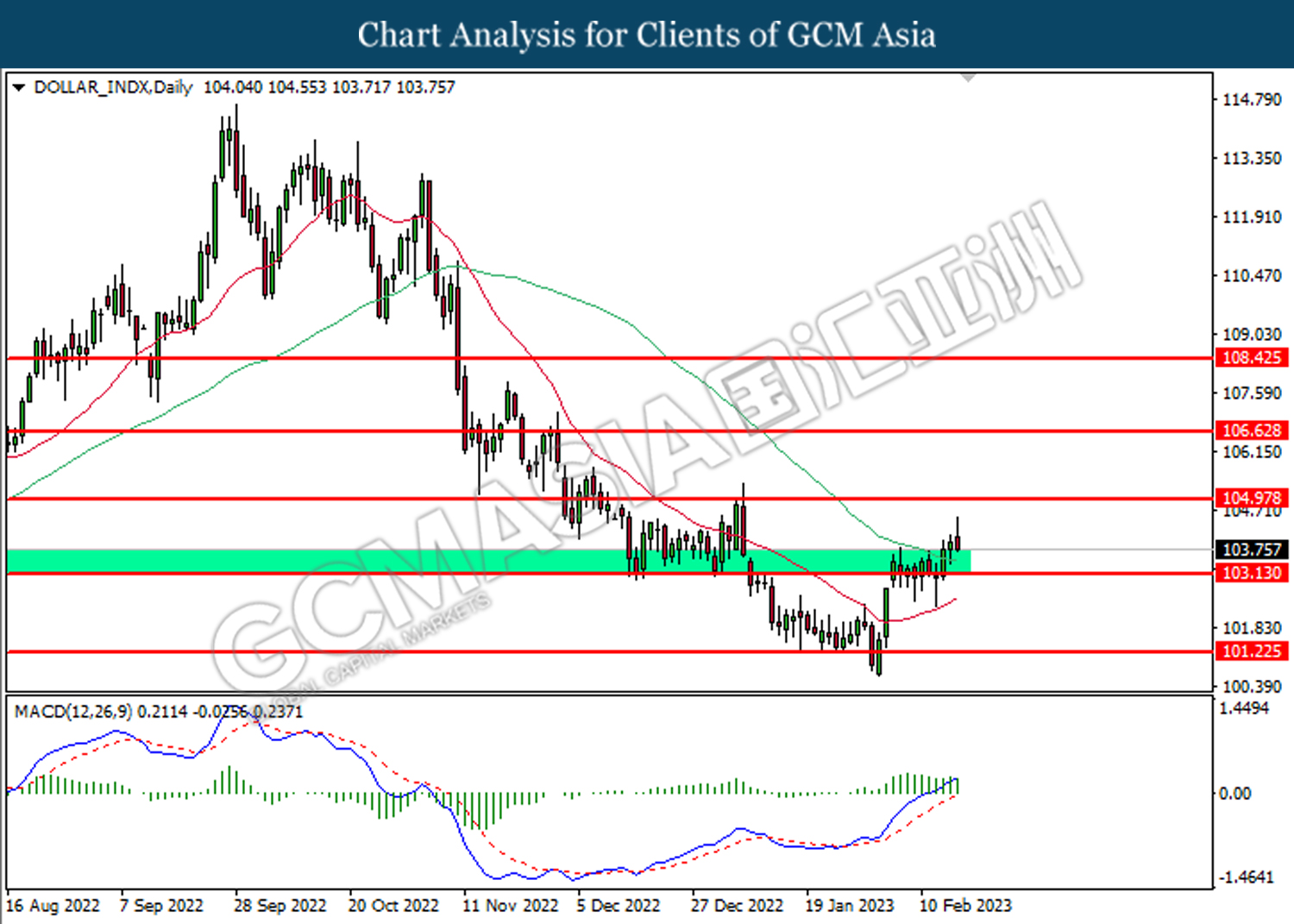

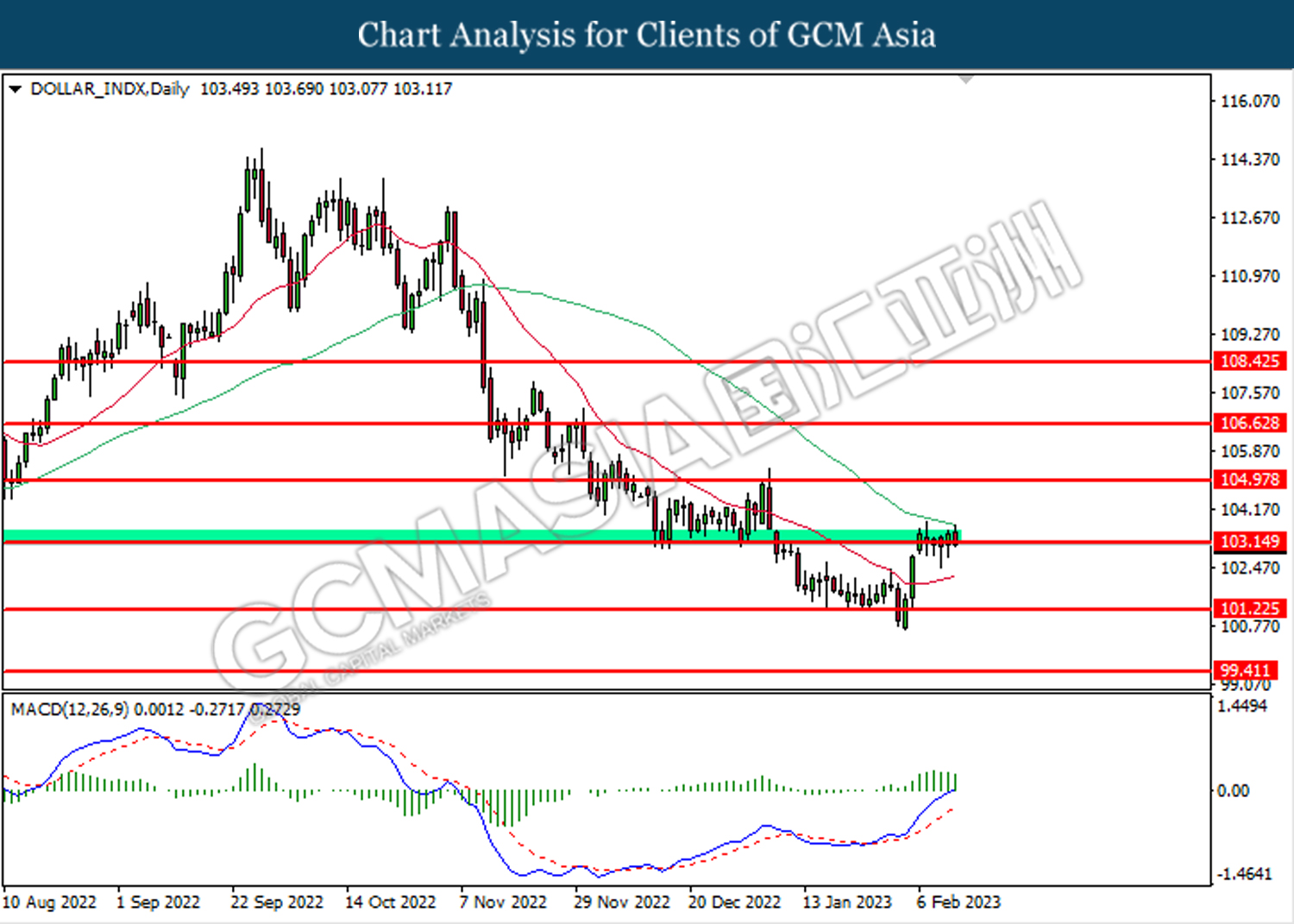

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

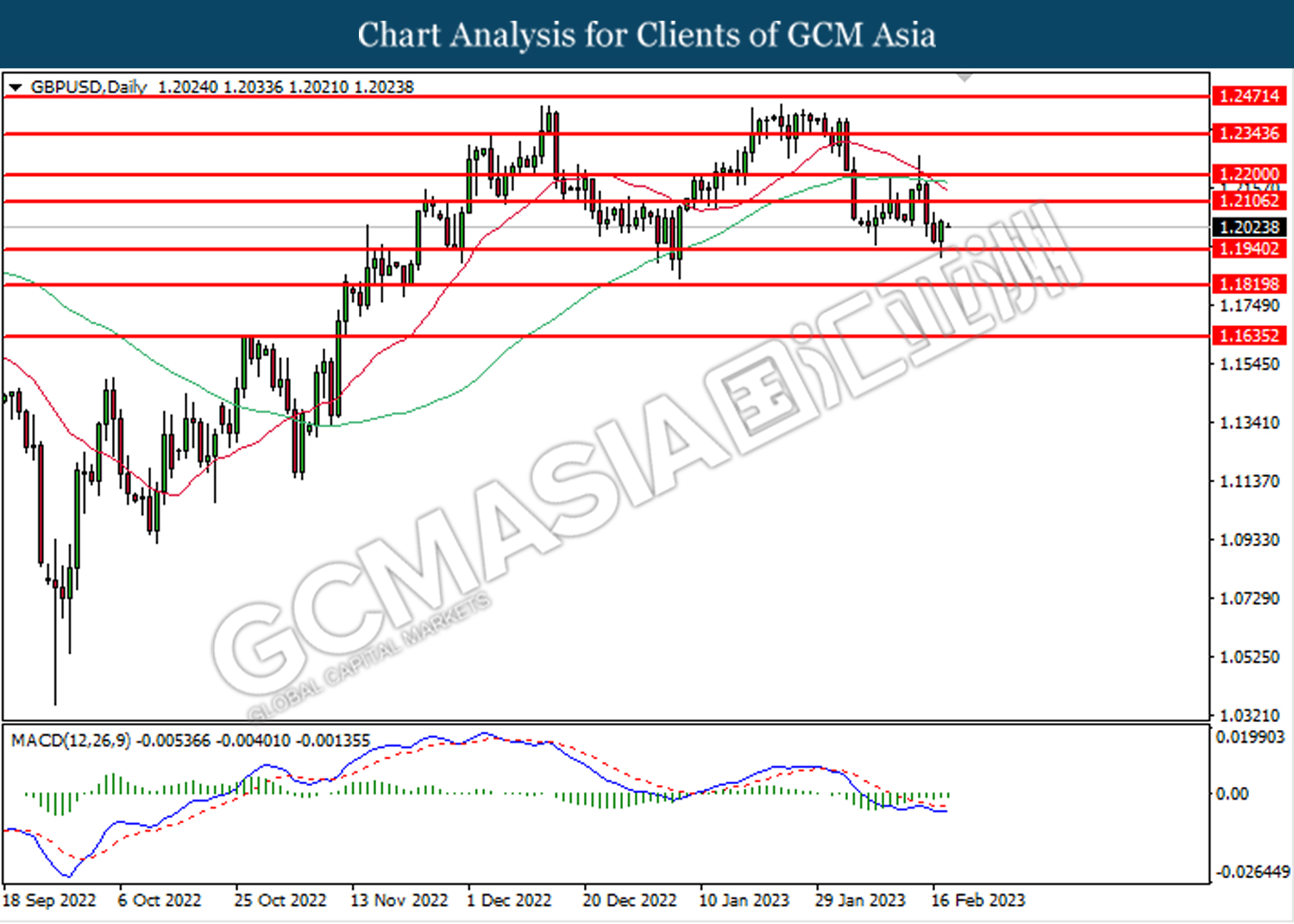

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

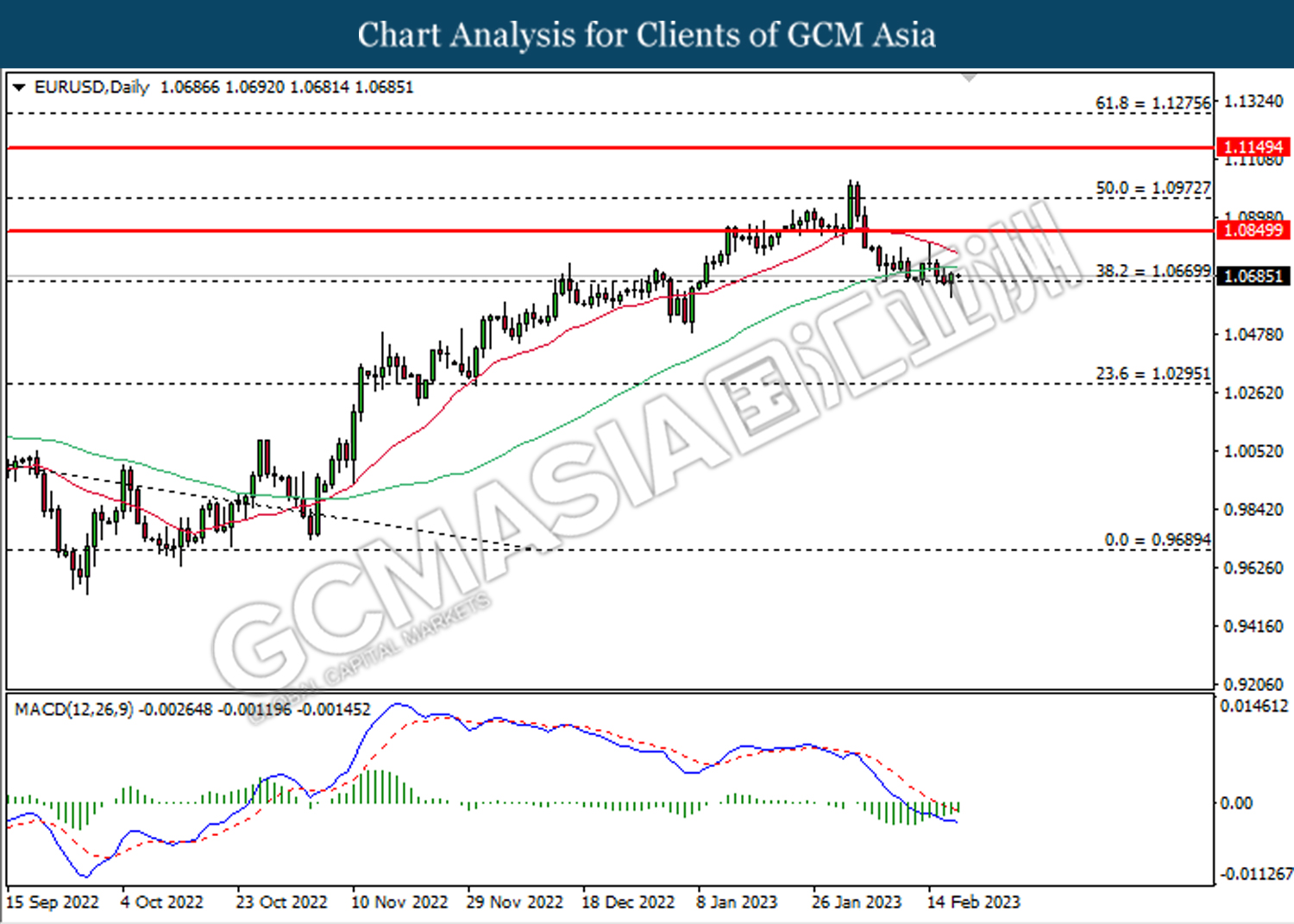

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

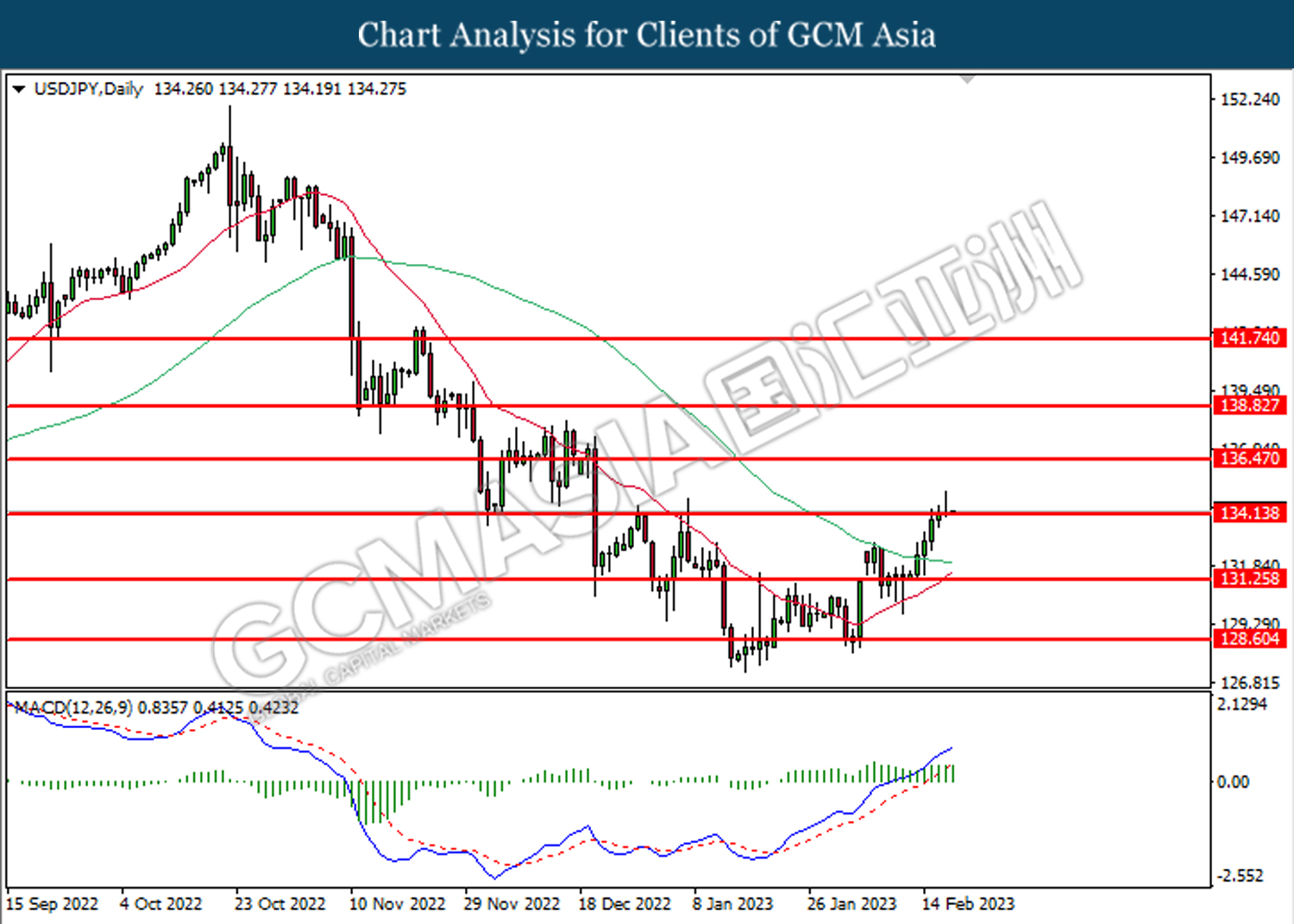

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45

200223 Afternoon Session Analysis

20 February 2023 Afternoon Session Analysis

EUR rebounded amid economic condition improvement.

The EUR strengthened against USD as upbeat economic data from Eurozone boosted investor confidence. According to recent reports, Germany’s producer price index (PPI) hit -1.0%, which is above the expectation of -1.6%. At the same time, the French Consumer Price Index (CPI) stood at 0.4%, higher than the previous month’s readings of -0.1%. Both data showed the Eurozone economic conditions improved, boosting investor confidence. Simultaneously, the data also gives European Central Bank (ECB) more room for monetary policy tightening, as the current inflation figure is still far away from the ECB’s 2% target for inflation across the countries. As a result, the EUR experienced a wave of appreciation on Friday. Besides, the slip in the US dollar market also boosted the pair of EUR/USD amid investors waiting for more clear direction from Fed. The sentiment of the US dollar has remained weak in recent weeks, urging investors to shift their funds to riskier assets such as pounds, euros, and US stocks. As of writing, the EUR/USD depreciated by -0.05% to $1.0688.

In the commodities market, crude oil prices rebounded by 0.65% to $77.07 per barrel after a steep loss in the prior trading session amid rising supplies in the United States. Besides, gold prices appreciated by 0.08% to $1851.65 per troy ounce as the dollar index weakened.

Today’s Holiday Market Close

Time Market Event

All Day CAD Family Day

All Day USD Washington’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the resistance level at 104.45. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2010. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher following the prior rebound from the support level at 1.0635. However, MACD which illustrated increasing bullish momentum suggests the pair undergo technical correction in the short-term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0470

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 134.55. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior break above the previous resistance level at 0.6870. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6945.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded lower following a retracement from a higher level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following a rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.9240 However, MACD which illustrated bearish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 76.05. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 78.75, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1819.15. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1847.55

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1797.85

200223 Morning Session Analysis

20 February 2023 Morning Session Analysis

US dollar slumps ahead of Washington’s Birthday Holiday.

The dollar index, which is traded against a basket of six major currencies, lost its ground after hitting the highest level since the beginning of January as investors restructured their portfolio holdings while eyeing on further action from the Federal Reserve (Fed). Last week, several of the Federal Reserve members signaled an aggressive rate hike plan should be carried out going forward in order to cool down the persistent-high inflation. Such comments came after the inflation-related data, which included Consumer Price Index (CPI) and Producer Price Index (PPI) showed an unexpected rise on a month-to-month basis. With such a backdrop, the CME FedWatch Tool shows that the probability of an aggressive rate hike of 50 basis points has risen from the prior week’s reading’s 9.2% to 18.1% as of today, whereas the probability of a 25 basis point lingers near the level of 81.9%. Nonetheless, the focus the majority of investors are gathered on the upcoming crucial financial event and economic data, such as the FOMC Meeting Minutes and Gross Domestic Product (GDP), to scrutinize the future action of the Fed. As a side note, US markets will be closed today amid Washington’s Birthday Holiday. Thus, the liquidity may be low, and the movements are expected to be relatively minor. As of writing, the dollar index dropped by -0.02 to 103.90.

In the commodities market, crude oil prices were up by 0.02% to $76.35 per barrel after dropping sharply during Friday’s trading session amid the market concern over the Fed’s future action on tackling still-high inflation. Besides, gold prices edged up by 0.05% to $1843.50 per troy ounce as the US dollar sank into the red sea.

Today’s Holiday Market Close

Time Market Event

All Day CAD Family Day

All Day USD Washington’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

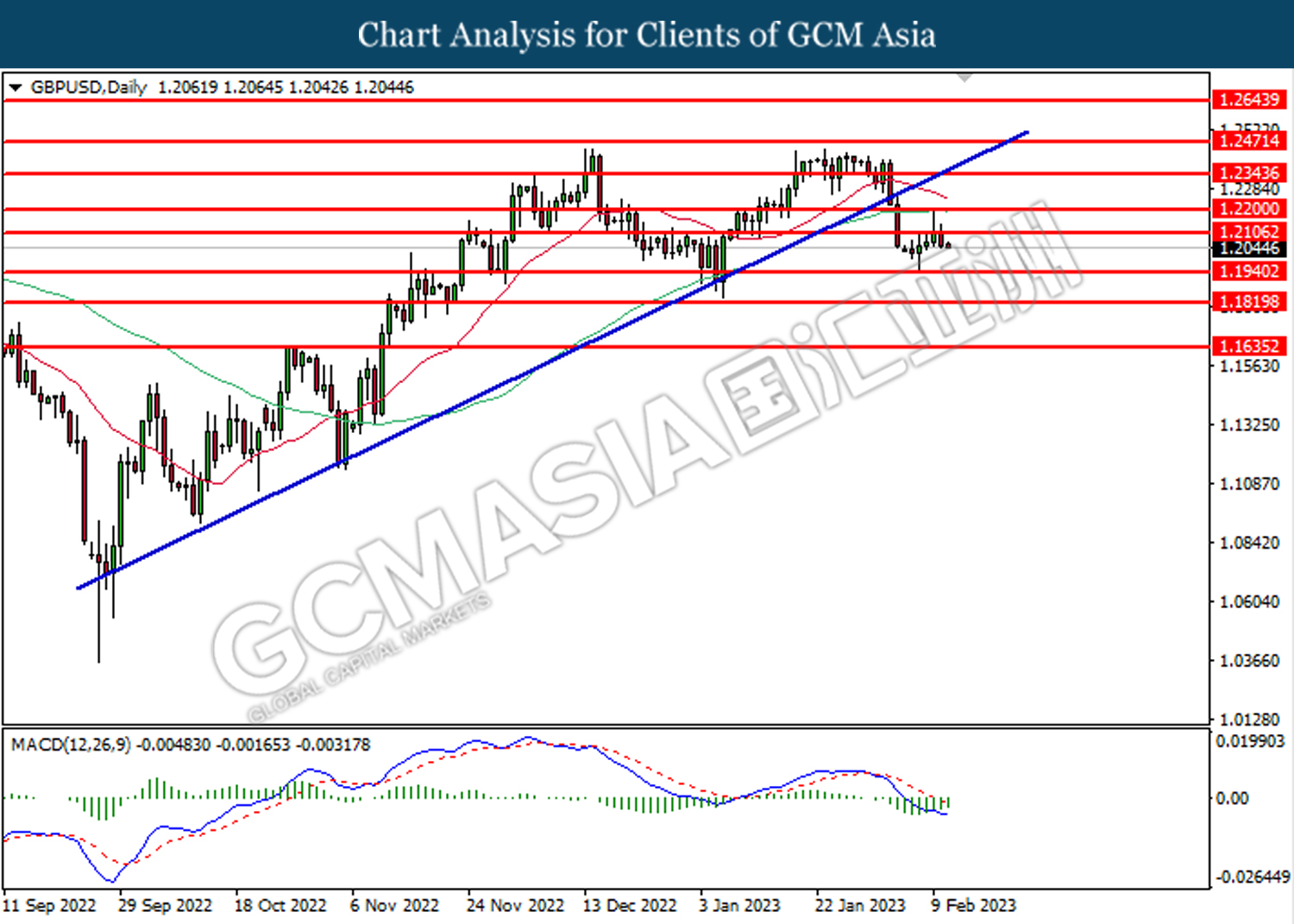

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0850.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6230. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6230, 0.6160

USDCAD, Daily: USDCAD was traded higher while currently testing near the resistance level at 1.3505. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1835.00 MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1859.90, 1884.00

Support level: 1835.00, 1786.00

170223 Afternoon Session Analysis

17 February 2023 Afternoon Session Analysis

Lowe hints inflation around the peak, Aussie slip afterward.

The Aussie, one of the major currencies traded by global investors, continued its downward trend for 3 consecutive days amid Lowe’s hint for inflation around the peak. The Reserve Bank of Australia (RBA) Governor mentioned in the statement that the consumer price index was in line with the forecast, it will decline to 4.75% over 2023 and to around 3% in the mid of 2025. With the global supply chain problems that have been relieved, shipping expenses, and oil prices off their peaks, the problem of high inflationary pressures is easing at the moment. Those remarks increased the investor’s expectation for a shift in RBA’s stance over the path of monetary policy. Moreover, Australia showed that its labor market remained fragile, which would stop the RBA from adopting an aggressive tightening move. According to the Australian Bureau of Statics, the employment change of Jan posted a negative reading at -11.5K, and unemployment rose by 0.2% to 3.7%. As of writing, AUD/USD slipped -0.49% to $0.6843.

In the commodity market, the price of crude oil edged lower by -0.92% to $77.77 a barrel amid investor-heightened concerns that the Fed would further tighten monetary policy and hit the oil demand. In addition, the price of gold edged down by -0.84% to $1836.20 per troy ounce amid hawkish comments over the interest rate hike from Fed officials.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lower level. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 104.45.

Resistance level: 104.45, 105.85

Support level: 103.00,101.70

GBPUSD, H4: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2010. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2010, 1.2145

Support level: 1.1900, 1.1765

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.6035.

Resistance level: 1.0850, 1.0975

Support level: 1.0635, 1.0465

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 134.55. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo a technical correction in the short-term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower following a prior break below the previous support level at 0.6870. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.6775.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.6195.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3420. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9240. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9320.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

CrudeOIL, H4: Crude oil price was traded lower following the prior break below the previous support level at 78.70. MACD which illustrated bearish momentum suggest the commodity to extend its losses toward the support level at 76.05.

Resistance level: 78.70,81.60

Support level: 76.05, 72.20

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1797.85

170223 Morning Session Analysis

17 February 2023 Morning Session Analysis

Dollar Index surged amid another hot inflation report.

The dollar index, which is traded against a group of six major currencies, extended its gains for another consecutive trading session as the US released another hot inflation report, indicating that the Federal Reserve (Fed) has not succeeded in curbing high inflation rates. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) decreased for the seventh consecutive month compared to the year before, reaching 6.0%, while the previous month’s reading was 6.5%. However, wholesale prices rose by 0.7% in January on a month-on-month basis, beating the consensus forecast of 0.4% and also the previous month’s reading of -0.2%. With that, it shows that price pressures are re-emerging in the US economy, where commodity prices remain on the rise even though the cash rate was raised to 4.75% in the last FOMC meeting. Therefore, rising inflationary pressures in the US may prompt the Fed to reconsider its more aggressive rate hike plans to moderate inflation in the US. Instead, the Greenback jumped more sharply amid tight labor market conditions, reflected by lower-than-expected unemployment claims over the past week. According to the Labor Department, US Initial Jobless Claims data reached 194K, missing the consensus forecast of 200K, reflecting the strength of the labor market. As of writing, the dollar index rose 0.08% to 104.00.

In the commodity market, the price of crude oil dropped by -0.47% to $78.15 a barrel as the black commodity weighed on a big increase in US crude inventories and hopes of a strong demand recovery in China. In addition, the price of gold edged up by 0.06% to $1837.10 per troy ounce as the US dollar rose significantly following the release of the PPI report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Jan) | -1.0% | -0.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1835.00 MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1859.90, 1884.00

Support level: 1835.00, 1786.00

160223 Afternoon Session Analysis

16 February 2023 Afternoon Session Analysis

Pound Sterling plunged amid diminishing red-hot inflation.

The GBPUSD, which traded by majority of investors slumped on yesterday following the easing inflationary risk in the UK. According to Office for National Statistics, the UK Consumer Price Index (CPI) YoY for January notched down from the previous reading of 10.5% to 10.1%, missing the consensus forecast of 10.3%. With the data figure that showing lower-than-expected, it indicated that the slip of goods and services price in the UK, whereas decreasing the likelihood of aggressive rate hike from Bank of England (BoE). Prior to that, BoE was speculated to pause its rate hike path, after another 25 basis point hikes in March. With that, it prompted investors to stoke a shift on sentiment toward other assets. On the other hand, the EURUSD regained its luster on Thursday following the hawkish statement from European Central Bank (ECB). ECB President Christine Lagarde claimed on yesterday that the central bank was inclined to increase its rates by 50 basis points in March in order to curb sky-high inflation. As of writing, the GBPUSD appreciated by 0.21% to 1.2051, while the EURUSD rose by 0.21% to 1.0710.

In the commodities market, the crude oil price raised by 0.56% to $79.03 per barrel as of writing following the optimistic forecast from IEA upon oil demand this year has offset the stockpile in the US crude oil inventories. In addition, the gold price appreciated by 0.26% to $1840.94 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB Economic Bulletin

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Jan) | 1.337M | 1.350M | – |

| 21:30 | USD – Initial Jobless Claims | 196K | 200K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | -8.9 | -7.4 | – |

| 21:30 | USD – PPI (MoM) (Jan) | -0.4% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggests the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggests the pair to be traded lower as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45

160223 Morning Session Analysis

16 February 2023 Morning Session Analysis

US dollar buoyed amid decent Retail Sales data.

The dollar index, which is traded against a basket of six major currencies, extended its rally following the Retail Sales data showed a sharp increase over the month of January. According to the Census Bureau, US Retail Sales data came in at 2.3%, significantly higher than the consensus forecast at 0.8% while the previous reading was stood at -0.9%. On the other hand, the Core Retail Sales data, which excluding automobiles, also printed an outstanding result at 2.3%, beating the consensus estimation at 0.8%. Both data showed that the sales at retailer level are well-performing despite the rising inflation pressures. The dollar index moved up sharply right after the data were released as the upbeat data provided ample room for the Federal Reserve to tighten their monetary policy further if necessary. However, the eyes of the market participants are now gathered on another crucial inflation related data, which is the Producer Price Index (PPI). Earlier of the week, the US has released the long-awaited Consumer Price Index (CPI). However, the data confused the market with mixed reaction as the decline in the inflation pressures was missing the expectation of the economists. As of writing, the dollar index rose 0.63% to 103.85.

In the commodities market, crude oil prices were down by -0.20% to $78.70 per barrel after EIA reported its inventories level with a significant built over the past week. According to the EIA, the US Crude Oil Inventories data came in at 16.283M, missing the forecast at 1.166M.Besides, gold prices edged down by -1.00% to $1835.95 per troy ounce as the US dollar successfully regained its luster amid the upbeat retail sales data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB Economic Bulletin

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Jan) | 1.337M | 1.350M | – |

| 21:30 | USD – Initial Jobless Claims | 196K | 200K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | -8.9 | -7.4 | – |

| 21:30 | USD – PPI (MoM) (Jan) | -0.4% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1835.00 MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1859.90, 1884.00

Support level: 1835.00, 1786.00

150223 Afternoon Session Analysis

15 February 2023 Afternoon Session Analysis

Pound flips amid investor fears on UK recessions.

The Pound Sterling, as one of the major traded currencies by global investors, was traded lower following a strong rebound in the previous trading session. Initially, a series of strong labor market data including a negative changes in unemployment claims for the month of January and a lower unemployment rate of 3.7%, contributed some gains to the pound. However, the fears of investors over the possibility of the UK economy might slip into recession offset the pound’s upside. According to a Reuter’s poll, the UK economy is currently experiencing a recession, while the Monetary Policy Committee (MPC) intending to further increase the interest rate to curb the high inflation pressures. Besides, the drop in GBP was extended following the release of mixed CPI data from the US. The January CPI in yearly reading stood at 6.4%, slightly higher than the market expectation of 6.2% but still lower than the prior month’s 6.5%. This result gave the Fed to have more room for further monetary tightening. Thus, it strengthened the value of dollar index, urging the pound according to slip against US dollar. As of writing, the GBP/USD slipped -0.26% to $1.2138.

In the commodities market, crude oil prices dropped by -1.21% to $78.10 per barrel amid American Petroleum Institute (API) reported crude oil inventories were in a surplus over the past week. Besides, gold prices edged down to -0.67% to $1852.85 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Jan) | 10.5% | 10.2% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Jan) | -1.1% | 0.7% | – |

| 21:30 | USD – Retail Sales (MoM) (Jan) | -1.1% | 1.6% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 2.423M | 1.166M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 104.45.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2105. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 1.2230, 1.2445

Support level: 1.2145,1.2010

EURUSD, H4: EURUSD was traded lower following the prior retracement from the resistance level at 1.0790. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635.

Resistance level: 1.0790,1.0900

Support level: 1.0635, 1.0470

USDJPY, H4: USDJPY was traded higher following the prior breakout above the previous resistance level at 132.30. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short-term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after toward the support level at 0.6945.

Resistance level: 0.7040, 0.7120

Support level: 0.6945, 0.6870

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6325. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6265.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9240

Resistance level: 0.9240, 0.9320

Support level: 0.9195, 0.9140

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 78.70. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully break below the support level.

Resistance level: 81.60,85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1847.55. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1876.90.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15

150223 Morning Session Analysis

15 February 2023 Morning Session Analysis

US dollar firmed after US inflation report.

The dollar index, which is traded against a basket of six major currencies, managed to hold its ground after the nation released its inflation report yesterday’s night. The initial greenback market reaction was a drop in value following the release of the inflation figure, but it managed to regain its luster and ended the trading session with some gains. According to the US Bureau of Labor Statistics, the US Consumer Price Index (CPI) dropped from 6.5% to 6.4% in the month of January on a year-over-year basis, yet it still slightly higher than the economist forecast at 6.2%. With that, it showed that the US inflation is still sticky, whereby it raised the likelihood that the Federal Reserve (Fed) would be necessary to keep the interest rate elevated, at least until the inflation figure shows an obvious drop in the future. Following the US inflation report, the probability of a 50 basis point of rate hike edged up from the previous week’s 9.2% to 10.7 as of today, whereas the likelihood of a 25 basis point of rate hike ticked down from 90.8% to 89.3%, according to the CME FedWatch Tool. As of writing, the dollar index fell by 0.09% to 103.25.

In the commodities market, crude oil prices dropped by -0.40% to $79.00 per barrel after American Petroleum Institute (API) reported a large build in crude oil inventory over the past week. Besides, gold prices edged up 0.06% to $1854.45 per troy ounce amid the weakness in dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Jan) | 10.5% | 10.2% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Jan) | -1.1% | 0.7% | – |

| 21:30 | USD – Retail Sales (MoM) (Jan) | -1.1% | 1.6% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 2.423M | 1.166M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0850.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower following a prior breakout below the previous support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1835.00.

Resistance level: 1859.90, 1884.00

Support level: 1834.00, 1786.00

140223 Afternoon Session Analysis

14 February 2023 Afternoon Session Analysis

The pound gained ahead of crucial labor data.

The pound sterling, as one of the most traded currencies by global investors, regained its luster ahead of the economic data release. According to UK National Statistics, the market estimation of the average earnings index is at 6.2%, slightly lower than the previous month’s reading. However, the UK claimant count change for Jan is expected to drop from the previous reading of 19.7k to 17.9k. Prior to that, both of the data showed that the UK was experiencing a loosening labor market condition during the month of Dec 2022, but it flipped the table over afterward. According to the data released by the Office for National Statistics, the unemployment rate stood at 3.5%, the lowest in the past 48 years. With that, investors become more optimistic about the upcoming labor data. Besides, the pound was also boosted by the weakening position of the dollar due to an expectation of a lower US Consumer Price Index (CPI) for January. Investors expect upcoming CPI data will slightly reduce by 0.2% to 6.2% on an annual basis, and the Fed will further loosen its tightening monetary policy. As of writing, the GBP/USD appreciated by 0.10% to $1.2147.

In the commodities market, crude oil prices were down by -0.94% to $79.39 per barrel amid the U.S. government’s said it would release crude oil from its Strategic Petroleum Reserve (SPR) as mandated by lawmakers. Besides, gold prices edged up 0.30% to $1869.15 per troy ounce ahead of the inflation report release.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 6.4% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | 19.7K | 17.9K | – |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.4% | 0.4% | – |

| 21:30 | USD – CPI (YoY) (Jan) | 6.5% | 6.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 103.00. MACD which illustrated bearish momentum suggests the index to extend its losses after it successfully breakout the support level.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2145. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010,1.1900

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.0790.

Resistance level: 1.0790,1.0900

Support level: 1.0635, 1.0470

USDJPY, H4: USDJPY was traded lower following the prior breakout below the previous support level at 131.25. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward support level at 130.25.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6945. MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6325.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.9195. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9140.

Resistance level: 0.9195, 0.9240

Support level: 0.9140, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from a higher level. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 78.70.

Resistance level: 81.60,85.23

Support level: 78.70, 76.05

GOLD_, Daily: Gold price was traded lower following a prior retracement from a higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity trade higher as a technical correction.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15

140223 Morning Session Analysis

14 February 2023 Morning Session Analysis

US dollar teeters ahead of long-awaited CPI data.

The dollar index, which is traded against a basket of six major currencies, teetered on the verge of collapse as the market participant waited for the inflation report to scrutinize if there would be a pivot turn from Fed going forward. At this point in time, economists are expecting the Consumer Price Index (CPI) would drop from 6.4% to 6.2% on an annual basis, increasingly betting the Federal Reserve might take a step back further from its aggressive rate hike plan if the data shows a decent easing of inflationary pressure. A year ago, the Federal Reserve started its long journey of curbing persistent-high inflation by raising the interest rate unstoppably. With that, the inflation figure has been successfully brought down to 6.4% at the end of the year 2022 despite still being far away from the Fed’s long-term target of 2%. The first inflation figure for the year will undeniably provide a clearer picture to investors gauging the Fed monetary policy’s future path. It is noteworthy to warn that a higher-than-expected inflation number could cause markets to reconsider the possibility of keeping interest rates high for a long time, and if so, a trend reversal might be triggered. As of writing, the dollar index dropped -0.32% to 103.30.

In the commodities market, crude oil prices were down by -0.72% to $79.10 per barrel amid the renewed inflation fears overshadowed the oil cut plan from Russia. Besides, gold prices edged down -0.67% to $1853.45 per troy ounce ahead of the inflation report release.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 6.4% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | 19.7K | 17.9K | – |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.4% | 0.4% | – |

| 21:30 | USD – CPI (YoY) (Jan) | 6.5% | 6.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0850.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower following a prior breakout below the previous support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00

130223 Afternoon Session Analysis

13 February 2023 Afternoon Session Analysis

Loonies rose after a surprising labor data announcement.

The Canadian dollar, one of the most traded currencies by global traders, has shown a sign of improvement after a labor market data was announced last Friday. The CAD rose 0.8% against USD after the labor result was released. According to Statistics Canada, Canadian employment rose to 150k while the consensus forecast was just 15k, which showed a sharp increase in January. However, the January’s unemployment rate remained unchanged at 5, in line with the prior reading, but the reading was still lower than the forecast at 5.1%. All in all, the current labor market situation does not derail from the expected monetary policy outlook of the Bank of Canada (BoC), so it added some risk that BoC could further tighten the monetary policy going forward. Meanwhile, higher prices for oil, one of Canada’s main exports, also boosted the value of Lonnie. The oil prices settled higher as Russia announced a plan to reduce oil production by 500k barrels per day starting from next month. As of writing, the USD/CAD edged up 0.18% to $1.3369.

In the commodities market, crude oil prices were traded lower by -1.12% to $78.83 per barrel ahead of the crucial US inflation figure tomorrow. During the Asian trading hours, oil prices retreated from its high level as Russia was struggling to find oil buyers, particularly after the implementation of sanctions from the western countries. Besides, gold prices edged down -0.02% to $1874.15 per troy ounce amid weakness in the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 104.45.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the resistance level at 1.2145. MACD which illustrated bearish momentum suggests the pair extend its losses toward the support level at 1.2010.

Resistance level: 1.2145, 1.230

Support level: 1.2010,1.1900

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.0790. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses towards the support level at 1.0635.

Resistance level: 1.0850, 1.0975

Support level: 1.0635, 1.0470

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 132.30

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6945. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 0.6870.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6325. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6265

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded higher following a rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9240. MACD which illustrated increasing in bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9320

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 78.70.

Resistance level: 81.60,85.23

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded lower following a prior retracement from the resistance level at 1876.90. MACD which decreasing bullish momentum suggests the commodity to extend its losses toward the support level at 1847.55.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15

130223 Morning Session Analysis

13 February 2023 Morning Session Analysis

US dollar climbs ahead inflation report.

The dollar index, which is traded against a basket of six major currencies, surged as investors remain cautious ahead of a blockbuster inflation report later this week. Two weeks before, the Federal Reserve adjusted their interest rate upward by 25 basis points, as widely expected. It is noteworthy to highlight that Fed Chairman Jerome Powell has finally admitted that inflation has started to ease, and the disinflationary process has begun especially in the goods sector. Nonetheless, Jerome Powell commented that there is still a long way to bring down the inflationary pressures, with a hint of more rate hikes in the future. Besides, the dollar index preserved its strength following the release of the Michigan consumer sentiment report. According to the University of Michigan, the US consumer sentiment revived further from the preliminary reading at 64.9 to 66.4 in the month of February, hitting the highest level in 13 months’ time. The better-than-expected sentiment in the US was mainly driven by the persistent tight labor market, where it reduced the market fears over the likelihood of a recession in the country. At this juncture, most of the investors are paying their attention over the upcoming inflation report to scrutinize the rate hike path of the Federal Reserve. Unexpected inflation figures would trigger large volatility in the market, causing uncertainty over the financial market. As of writing, the dollar index rose by 0.35% to 103.60.

In the commodities market, crude oil prices were up by 0.05% to $79.70 per barrel as Russia planned to reduce the oil production by 500k barrels per day last Friday. The retaliatory action was coming after the price cap sanction from the western countries against Russia. Besides, gold prices edged down -0.02% to $1865.90 per troy ounce amid weakness in the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.2105. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo short-term technical correction.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower following a prior breakout below the previous support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00

100223 Afternoon Session Analysis

10 February 2023 Afternoon Session Analysis

Pound slipped after Andrew Bailey’s speech.

The Pound Sterling, one of the most traded currencies by global investors, reversed from its upward trend after the governor of the Bank of England Andrew Bailey speech. Following a series of rate hikes since last year, Bailey told the members of parliament that the inflation rate of the UK is forecasted to drop sharply this year. The central bank has predicted that the inflation rate will drop from 10.5% to 4% by the end of 2023. Thus, investors increased their expectation that the upcoming UK monetary policy rate decision will be more dovish. According to a prior statement from IMF, the UK economy will enter into contraction by -0.6% in 2023, this has also led to investors expecting a more dovish stance from BoE. At this juncture, investors are waiting for more cues from the upcoming GDP report, which will be released later today. The UK yearly GDP reading is expected to have a growth of 0.4%, which is lower than the previous reading of 1.9%. As of writing, GBPUSD slipped -0.21% to $1.2096.

In the commodity market, the crude oil price edged down by -0.44% to $77.72 per barrel following the strengthening position of the dollar index. In addition, the gold price slipped by -0.50% to $1869.25 per troy ounce as the markets reassessed their expectations with more interest rate hikes from the Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15;00 | GBP – GDP (YoY) (Q4) | 1.9% | 0.4% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Dec) | -0.5% | -0.2% | – |

| 21:30 | CAD – Employment Change (Jan) | 104.0K | 17.3K | – |

| 23:00 | USD – Michigan Consumer Sentiment (Feb) | 64.9 | 64.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6985. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following a prior rebound from the support level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00