130123 Morning Session Analysis

13 January 2023 Morning Session Analysis

US Dollar plunged after the essential inflation data announced.

The Dollar Index which traded against a basket of six major currencies received a significant bearish momentum following the inflationary risk in the US was lowered, which buoyed the expectation of lower rate hikes by Fed. According to the US Bureau of Labor Statistics, the US Consumer Price Index (CPI) MoM for December notched down from the previous reading of 0.1% to -0.1%, which is the first decline since June 2020. Last year, the US central bank had aggressively raised their interest rate as they committed to bring down the spiking inflation risk. As of now, the rate hike path has come out with a desired effect, as well as the market participants was anticipating that Fed would likely to scale back its rate hike pace. However, the losses experienced by US Dollar was limited after Fed members reiterated their aggressive rate hike stance. St. Louis Fed President James Bullard claimed on yesterday that the inflation target had went in the right direction. Nonetheless, he suggested the US central bank to increase its rate by exceeding 5% as soon as possible following the inflation remains far above the Fed’s 2% target. As of writing, the Dollar Index eased by 0.90% to 102.00.

In the commodity market, the crude oil price dropped by 0.05% to $78.25 per barrel as of writing. Yesterday, the oil price spiked over the reducing of inflation risk in the US has dialed down the worries of recession. On the other hand, the gold price appreciated by 0.05% to $1897.64 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) | 1.5% | 0.3% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Nov) | 0.70% | -0.20% | – |

Technical Analysis

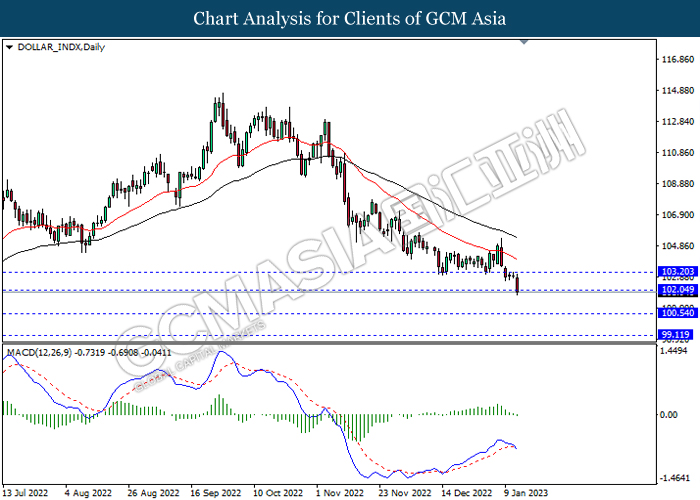

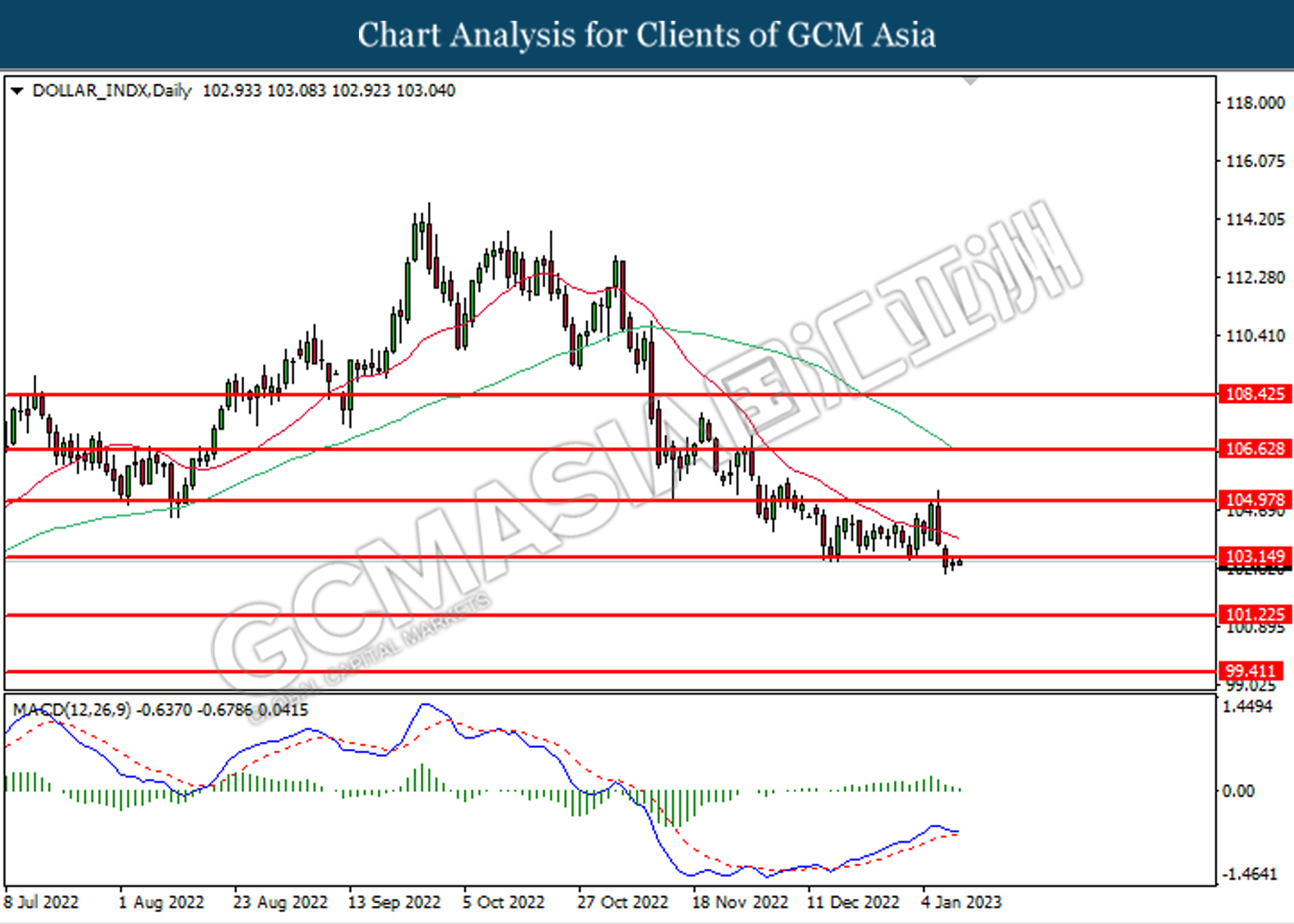

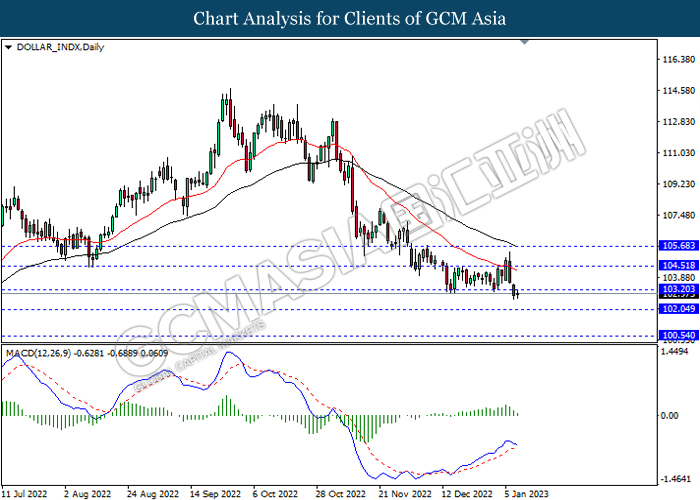

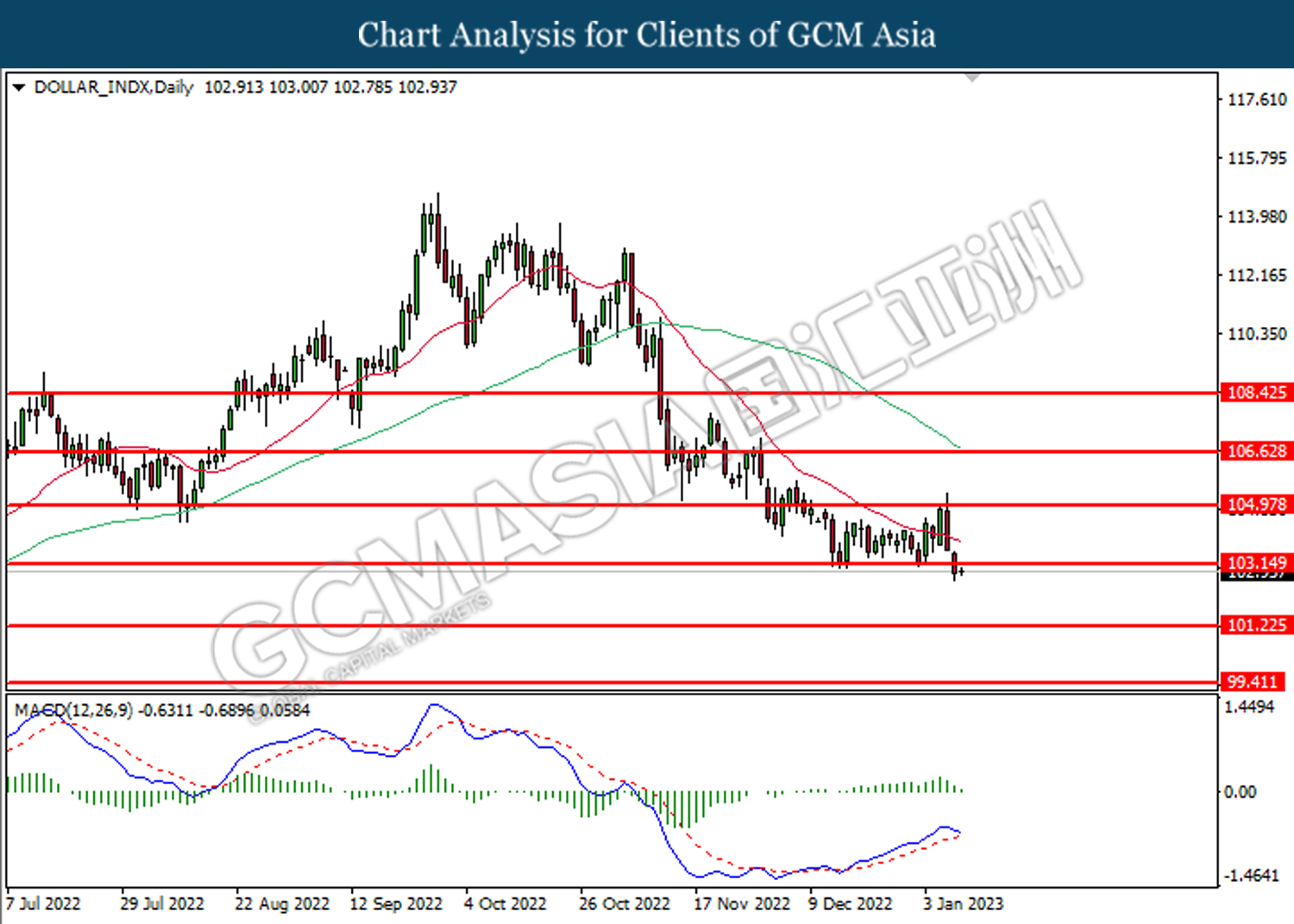

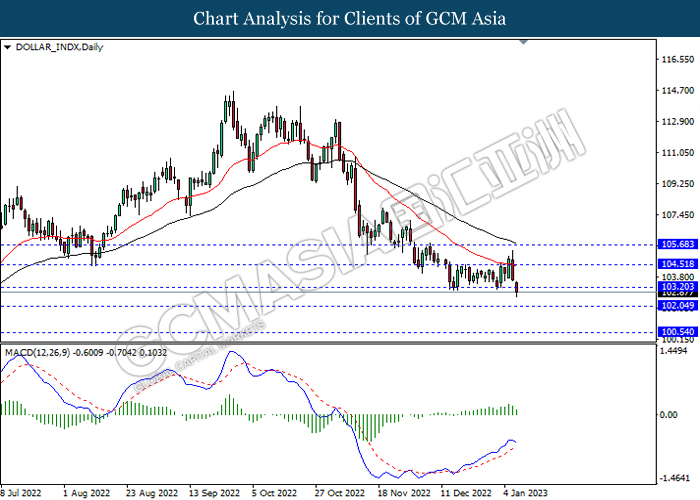

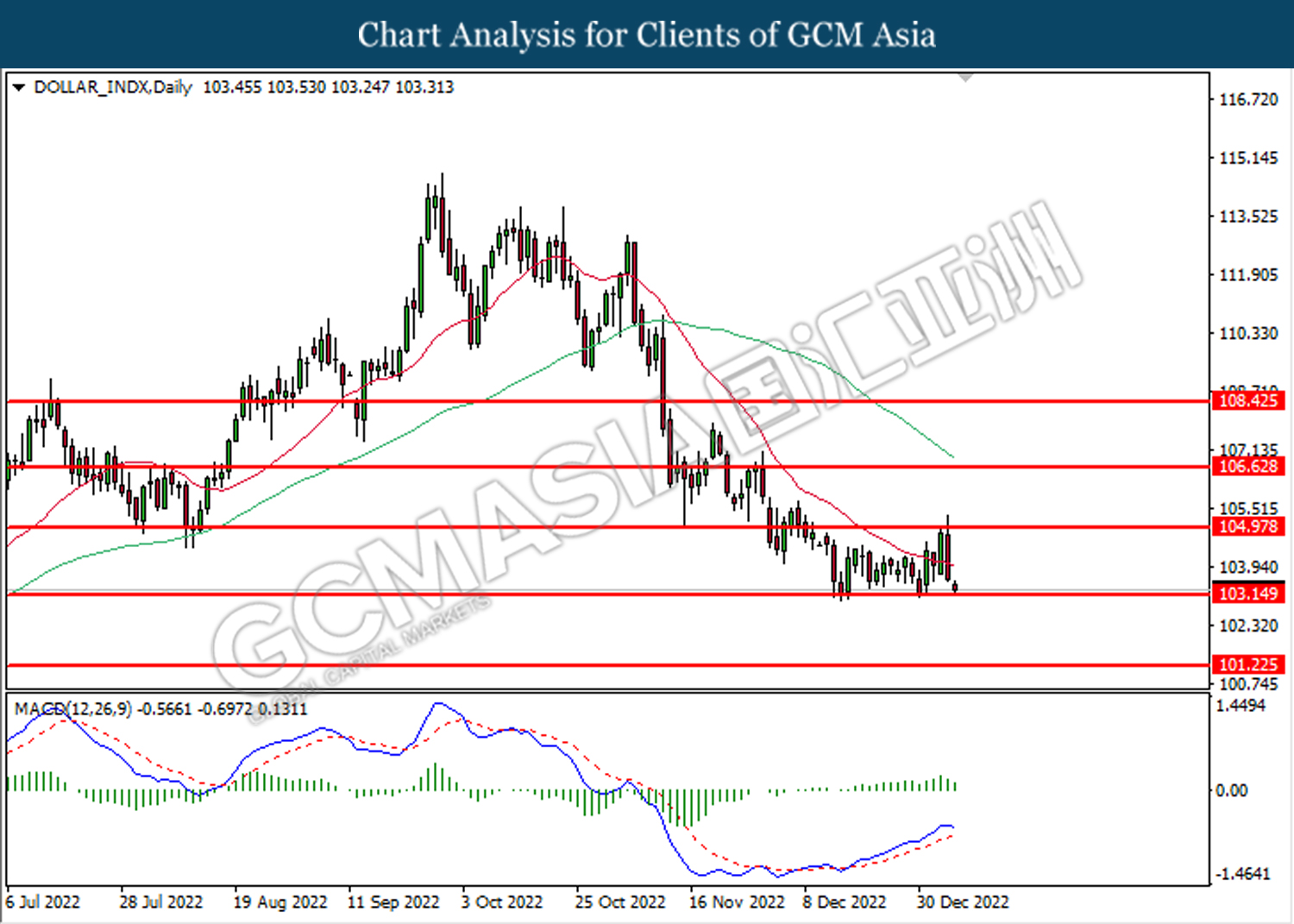

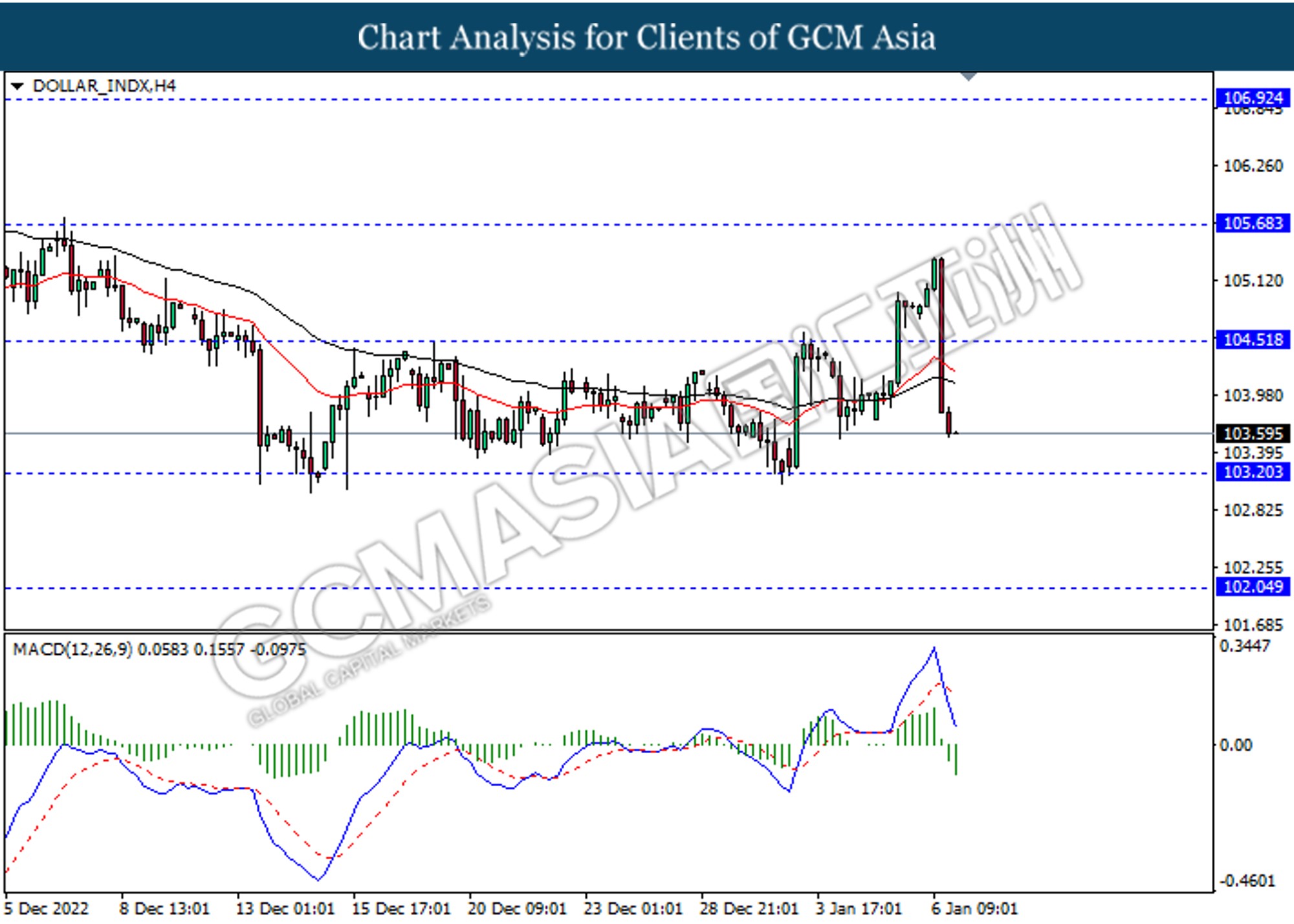

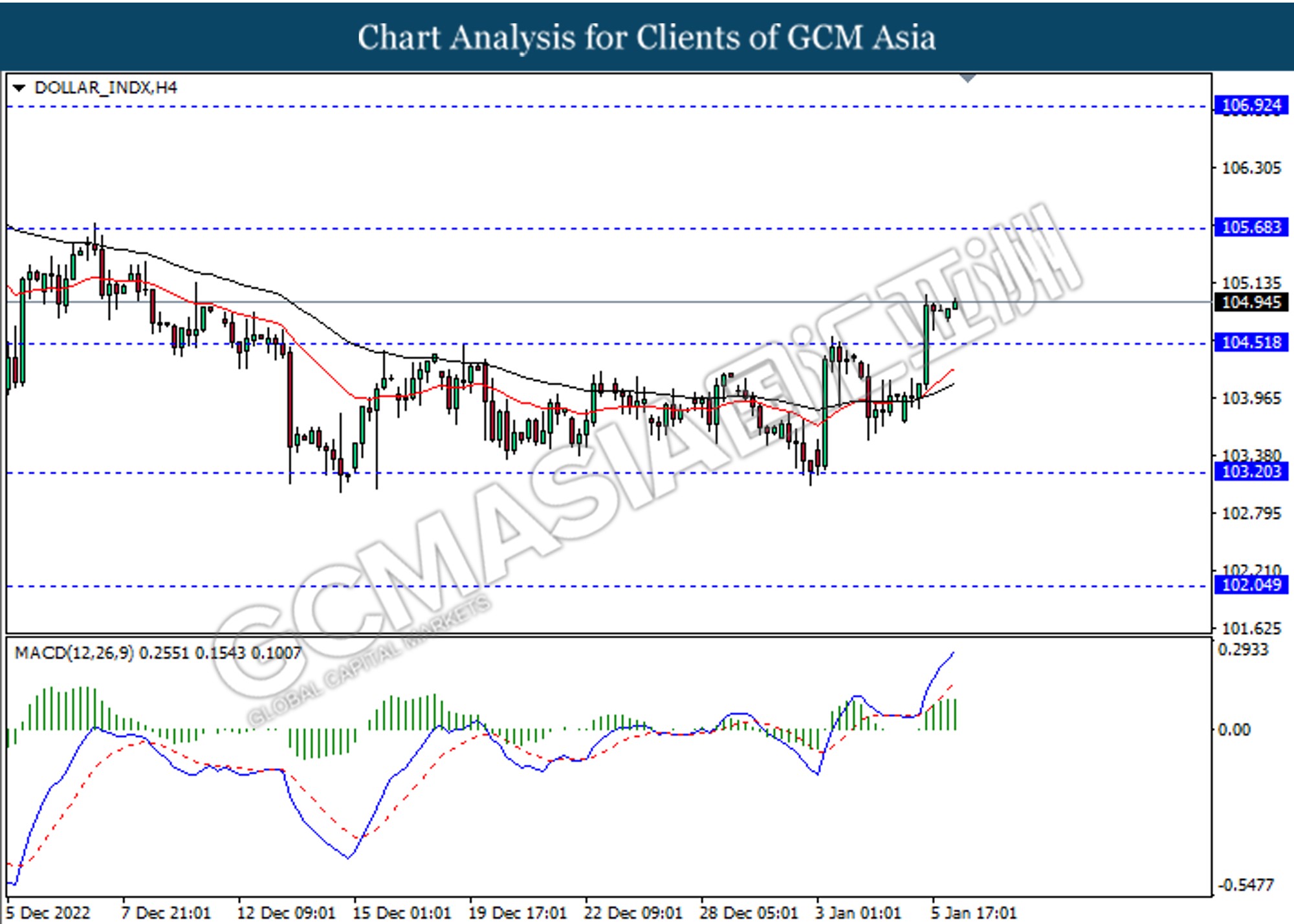

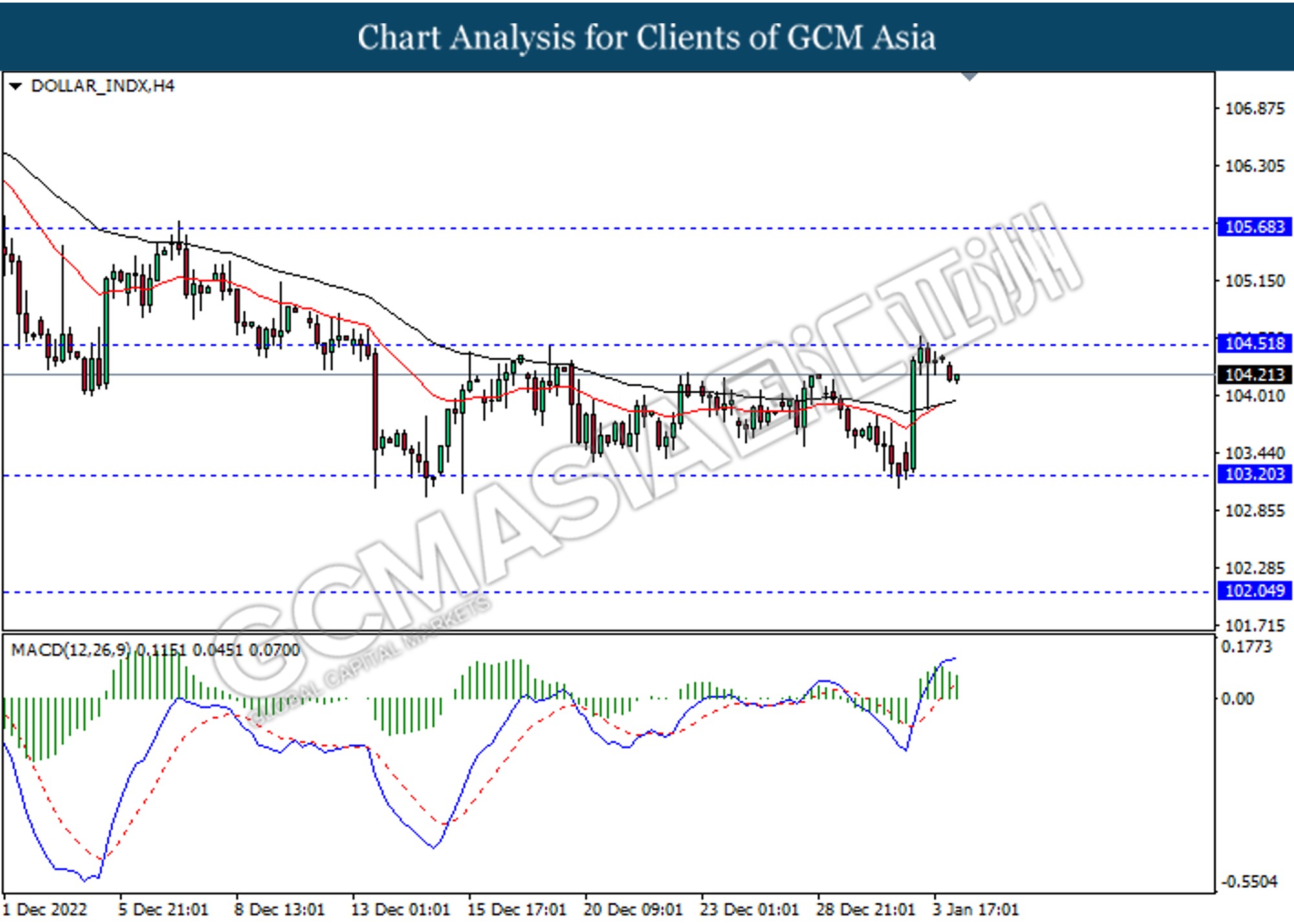

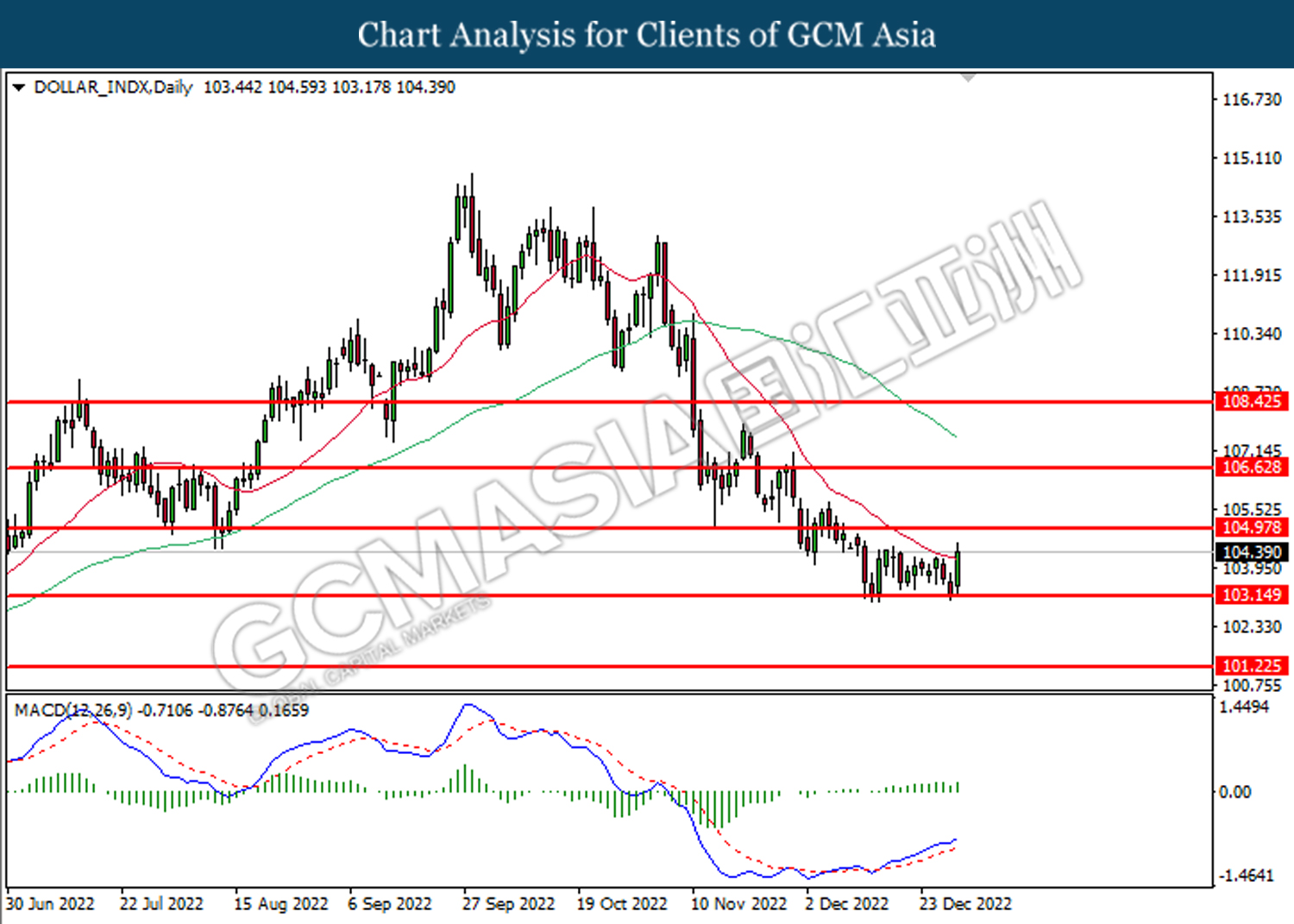

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

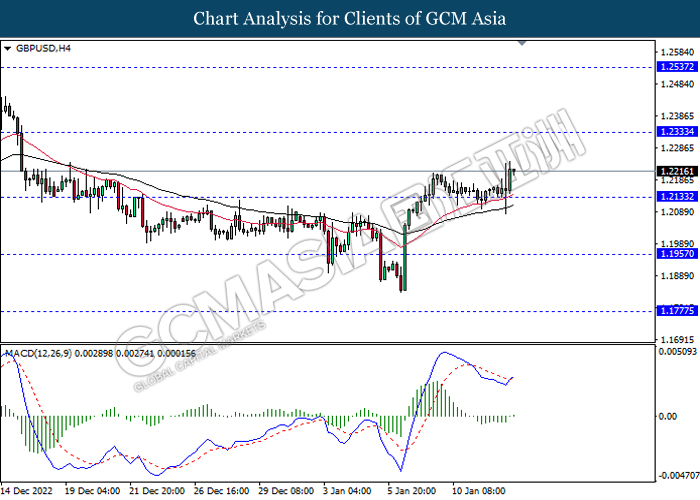

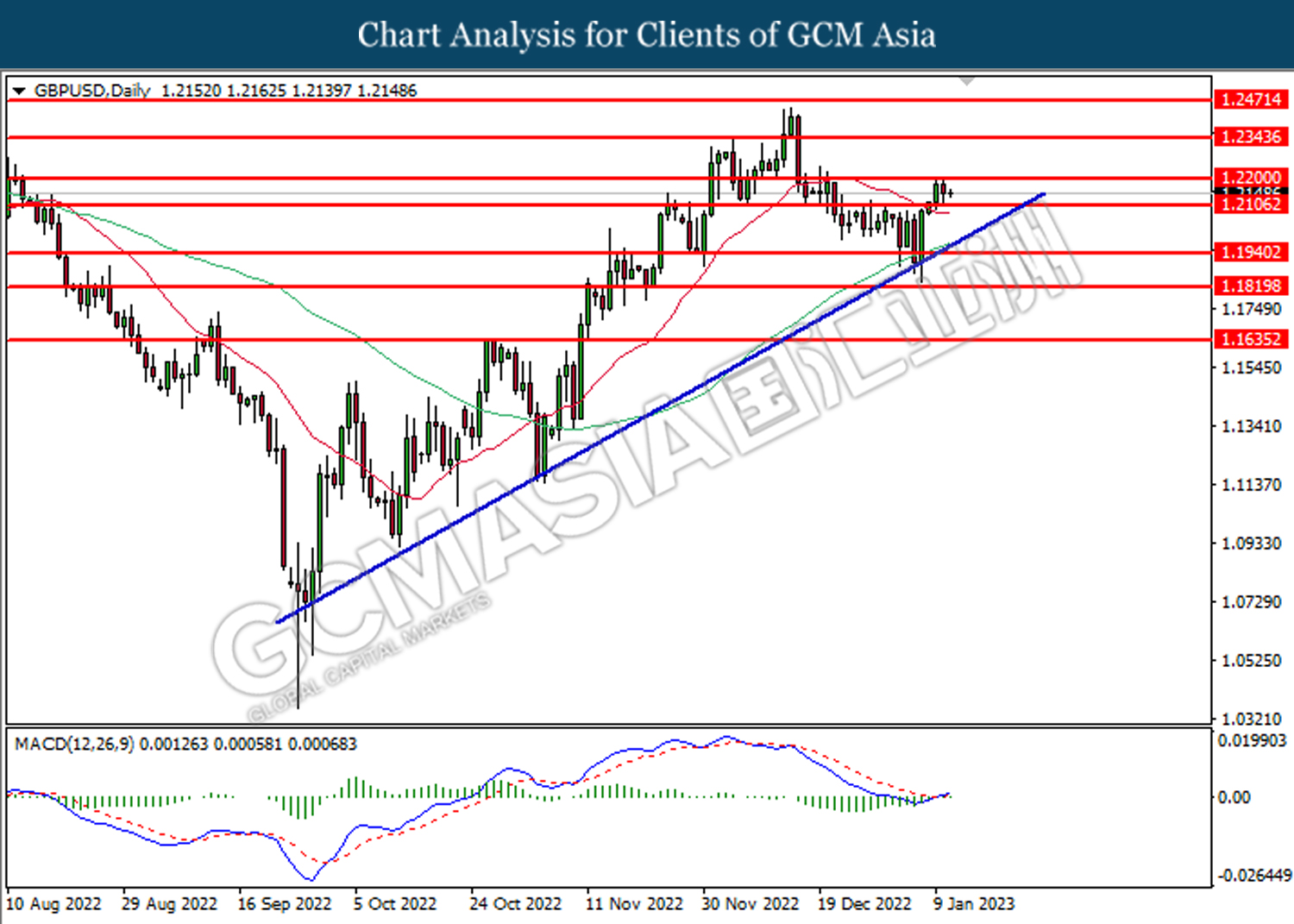

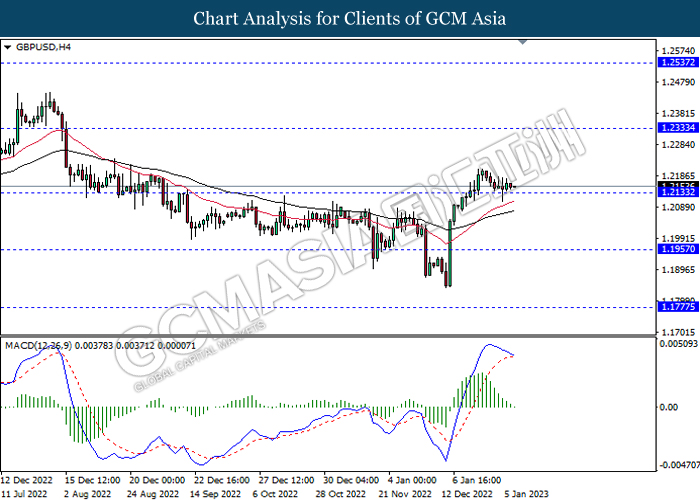

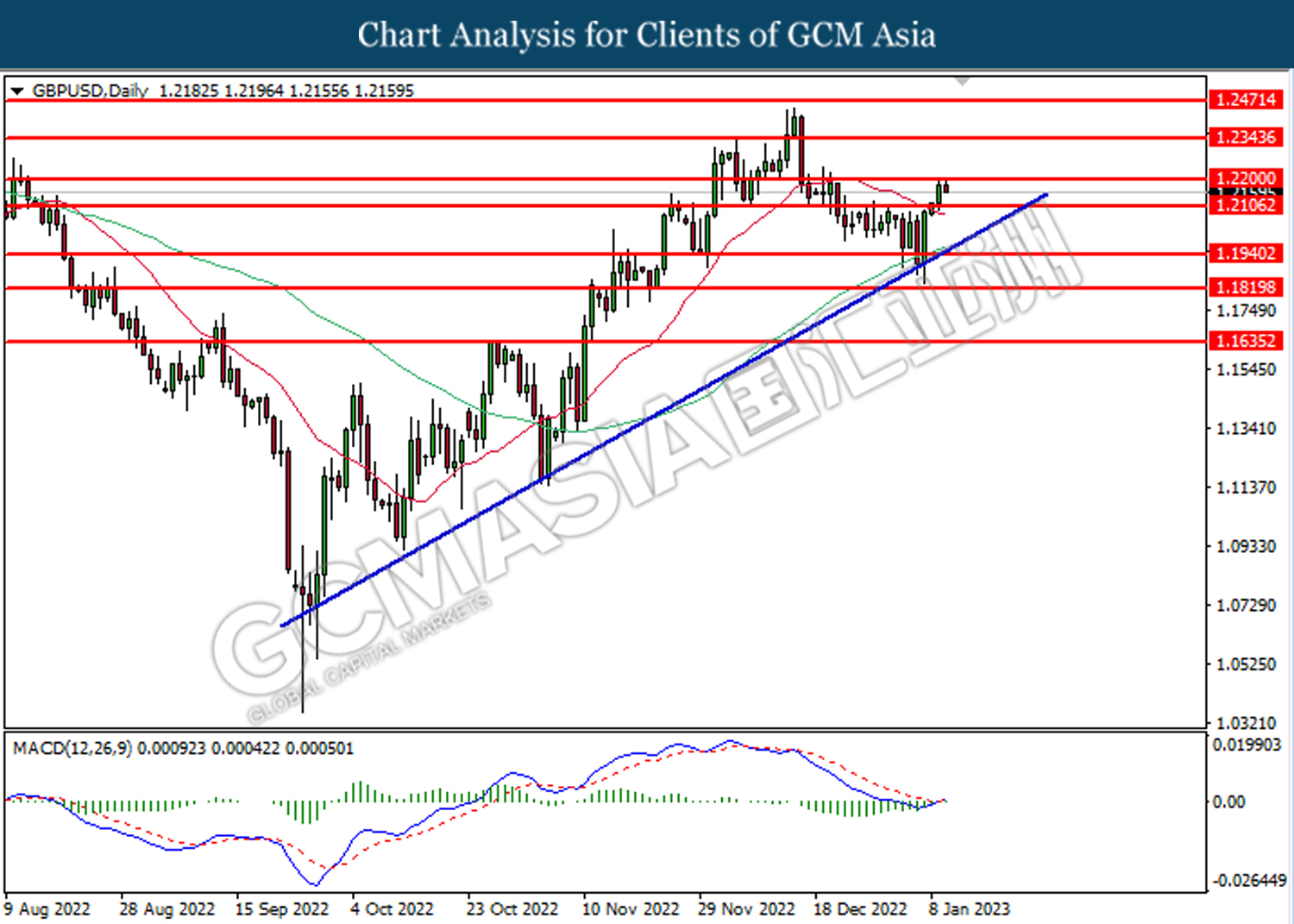

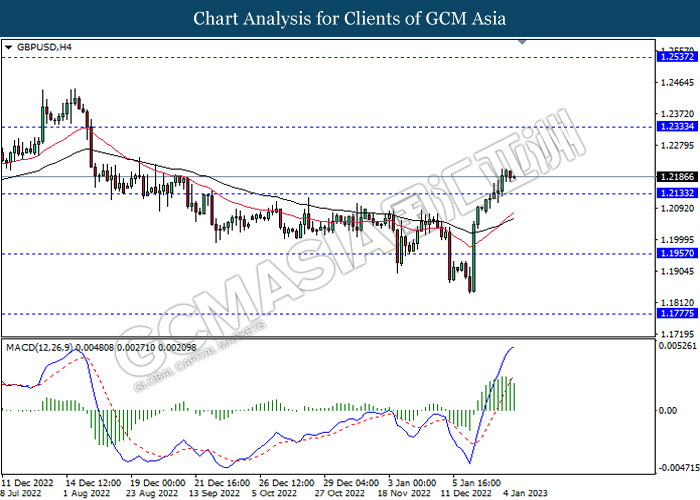

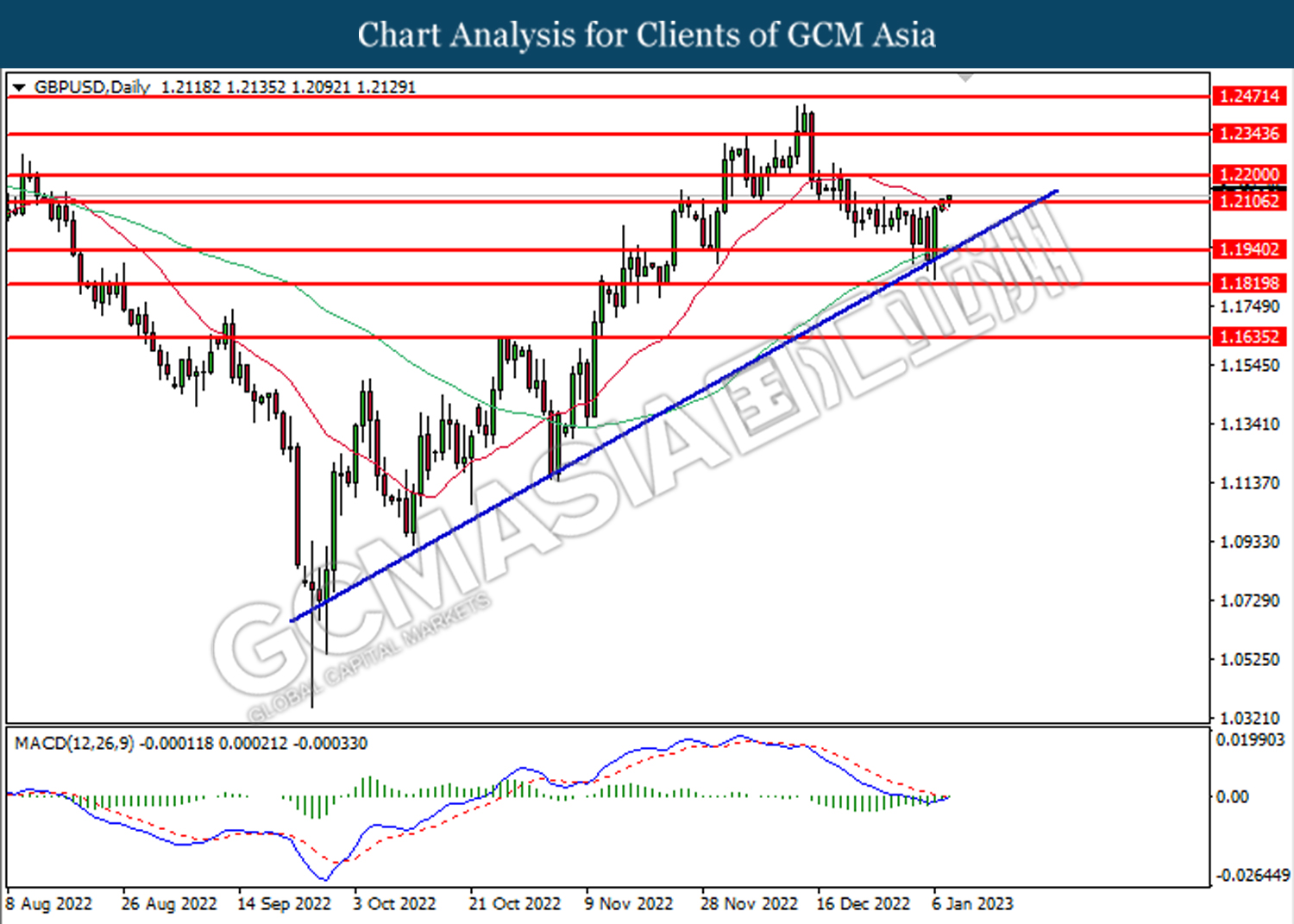

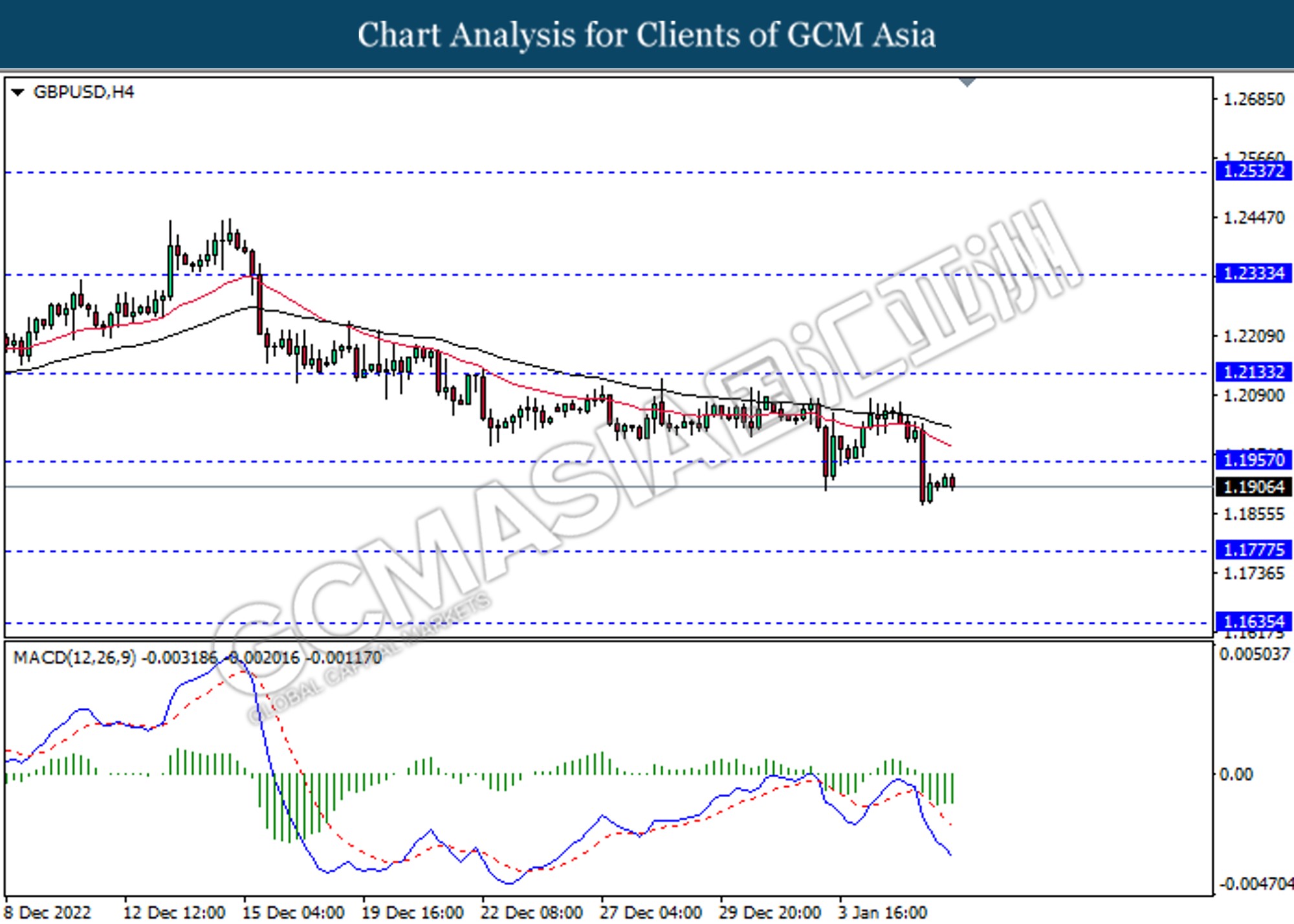

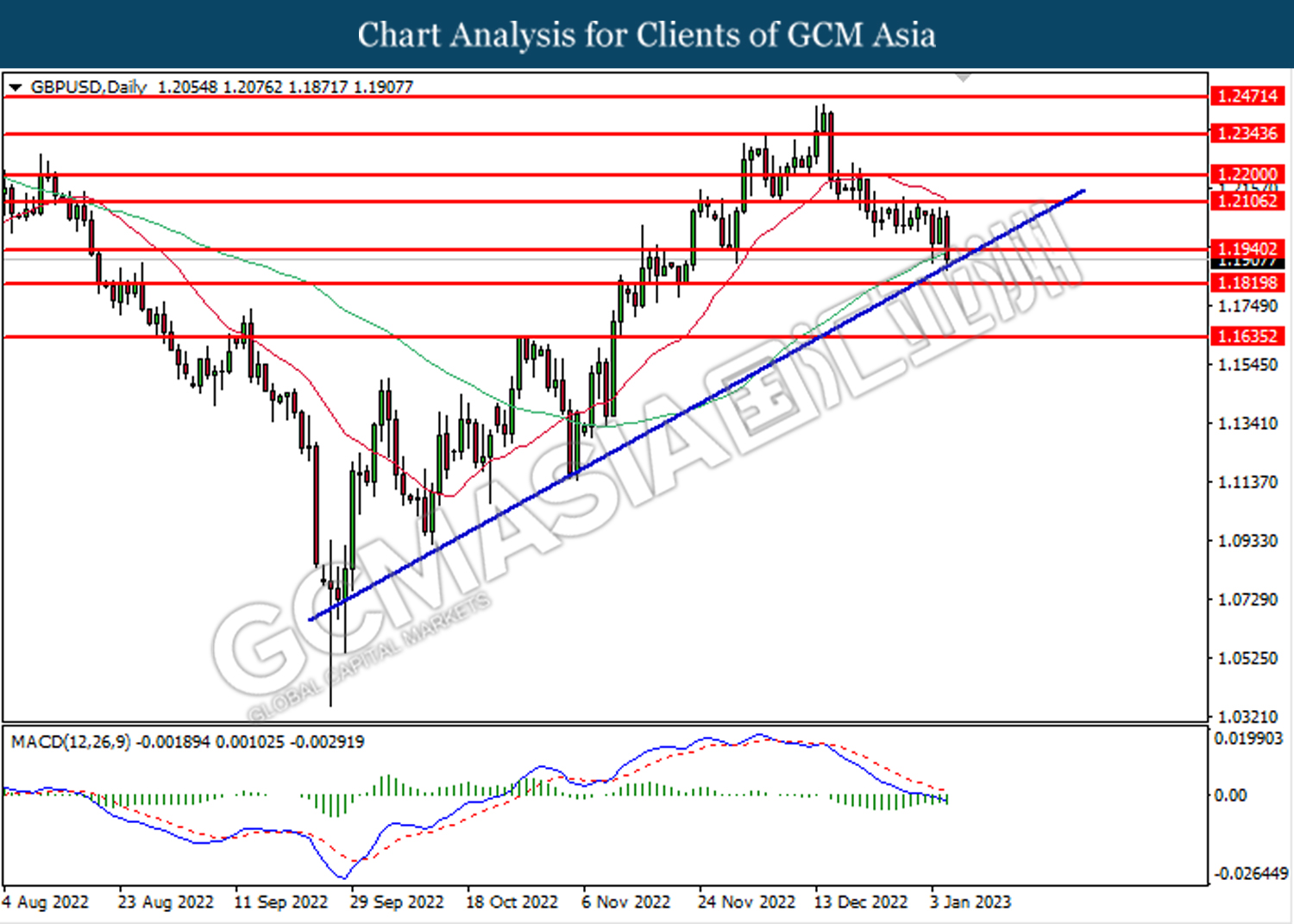

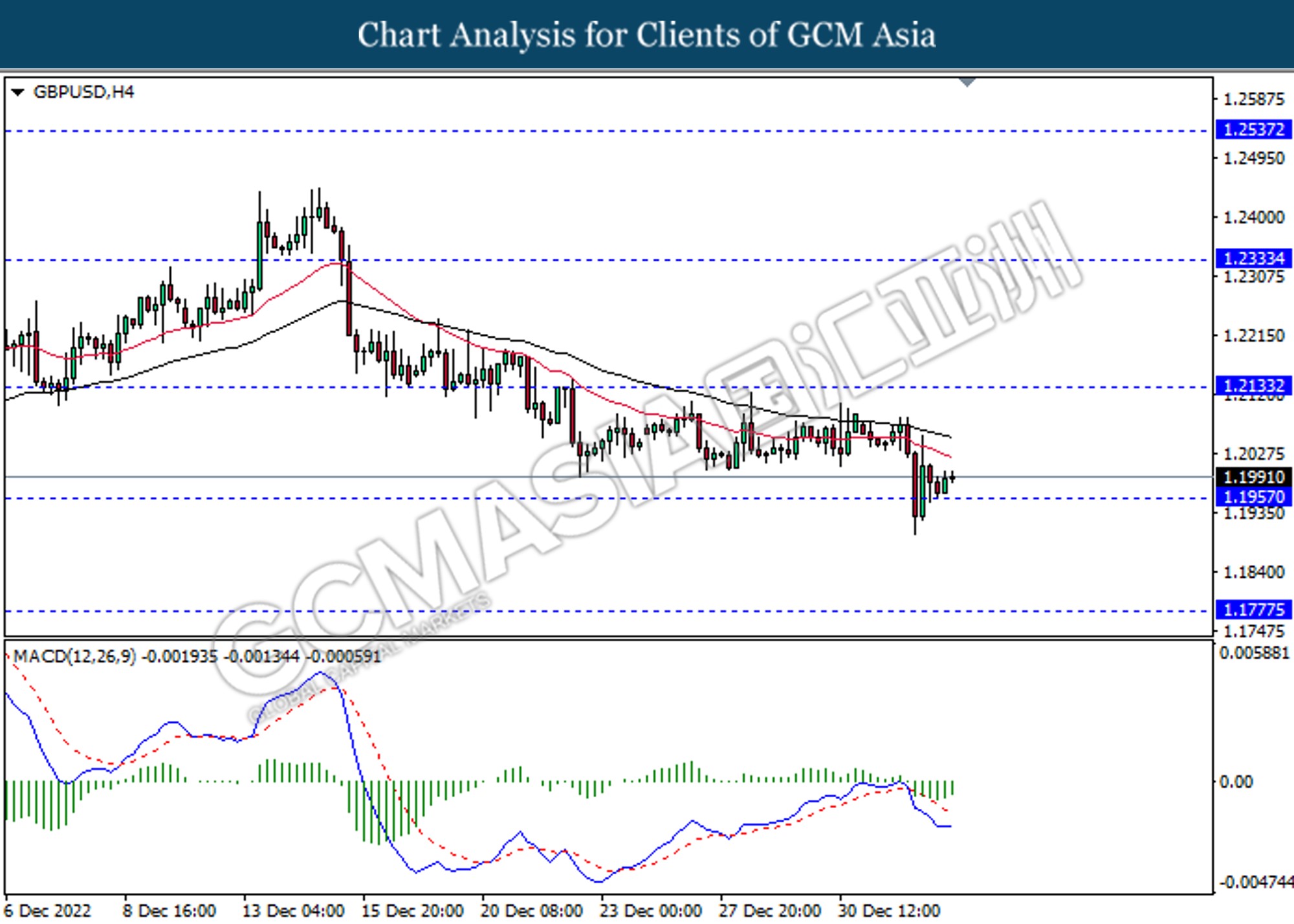

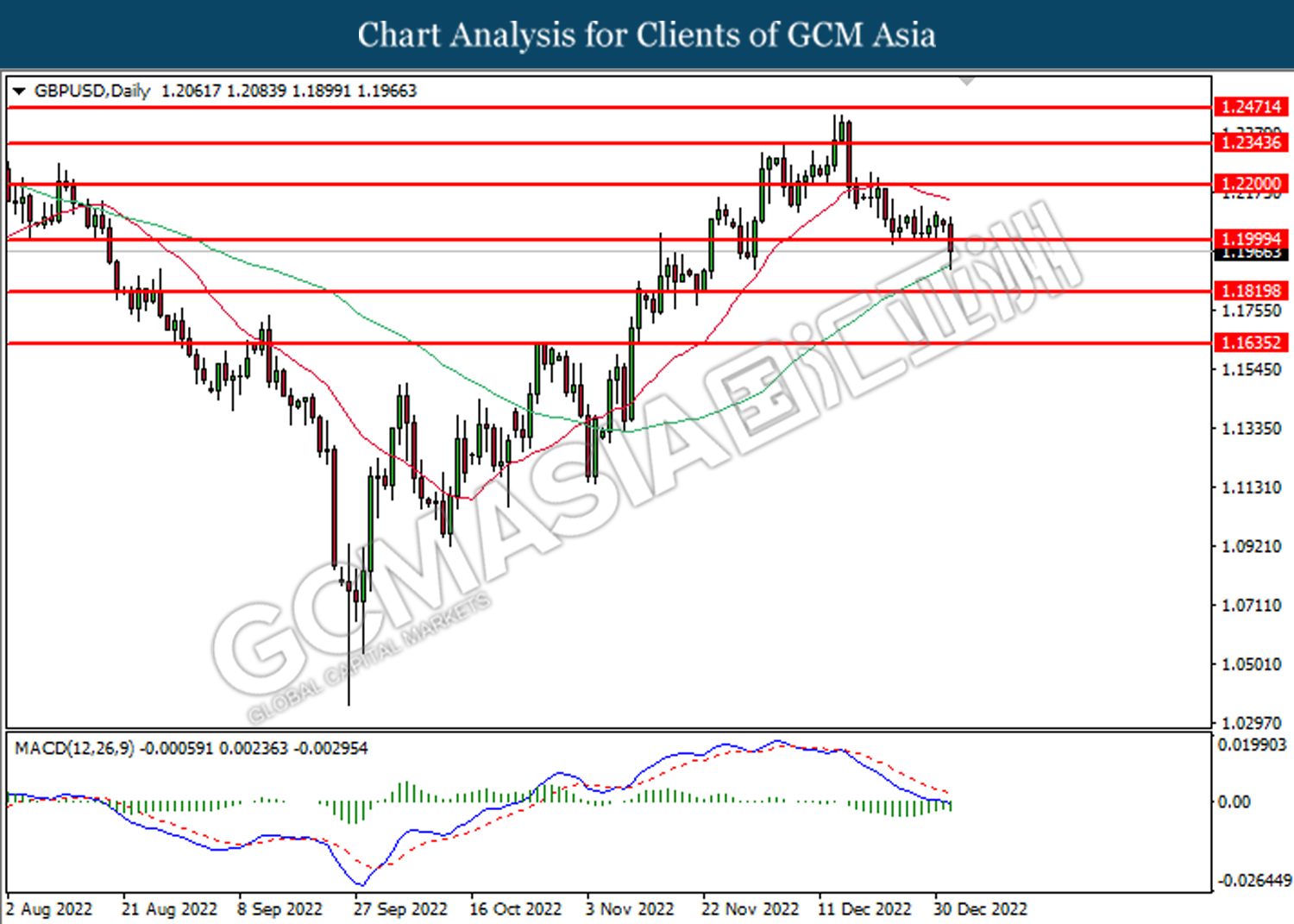

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

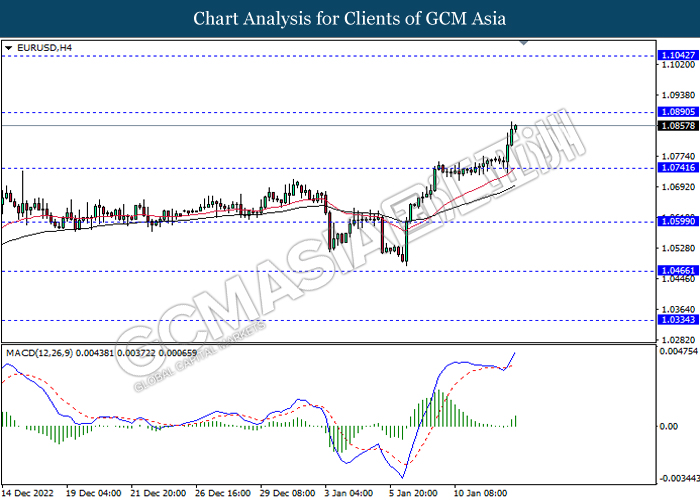

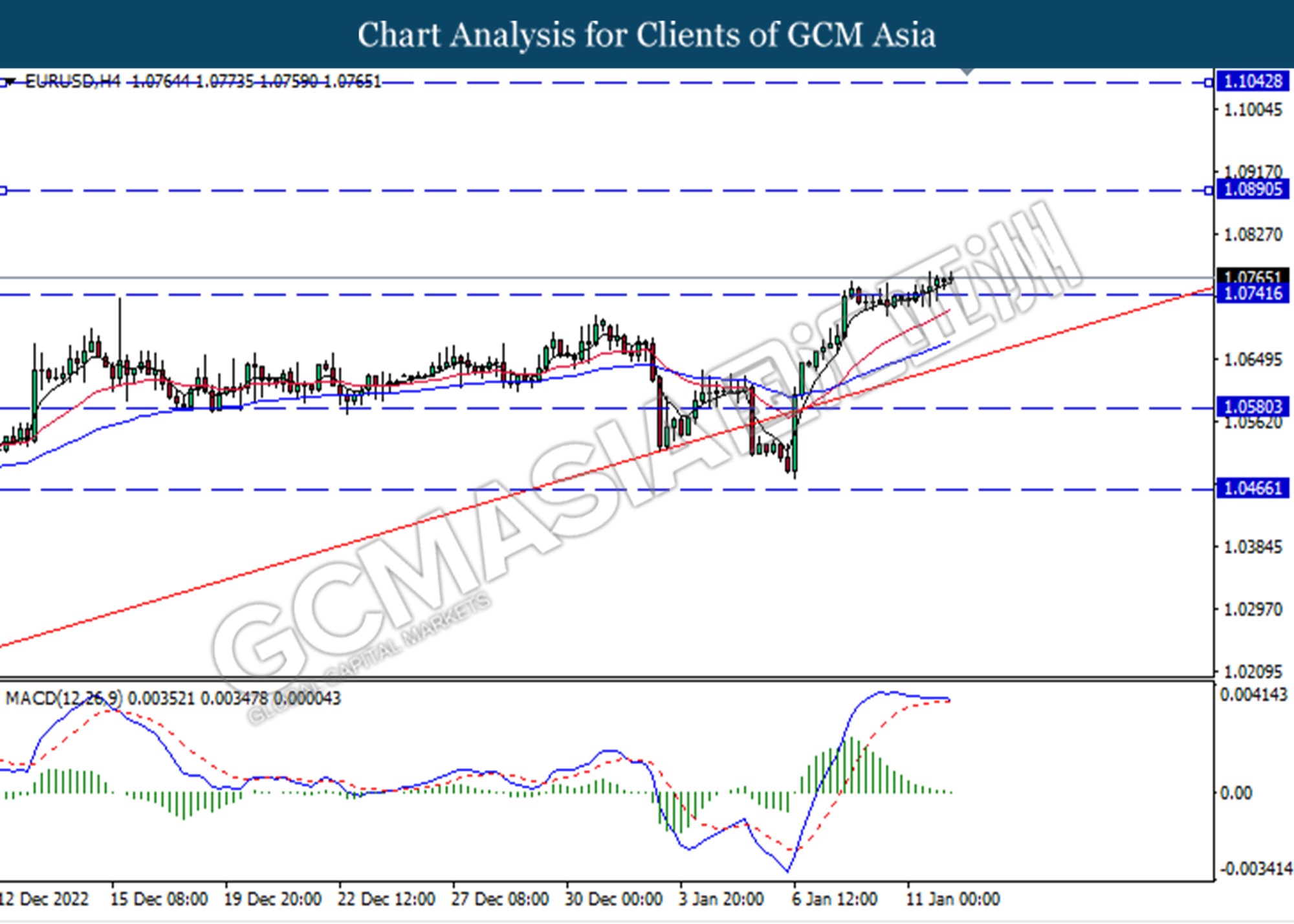

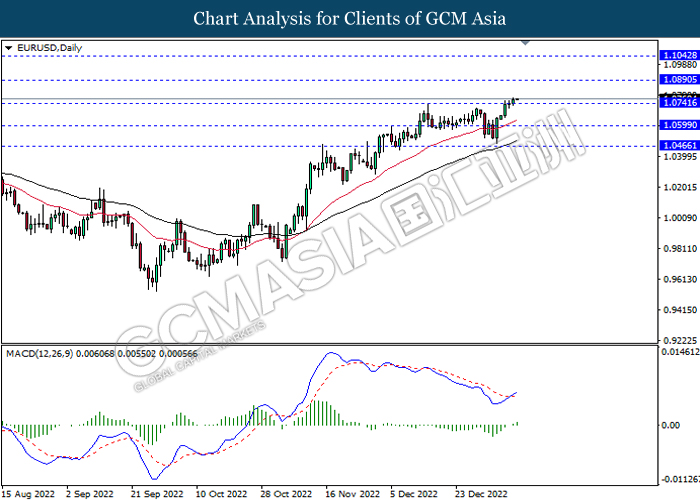

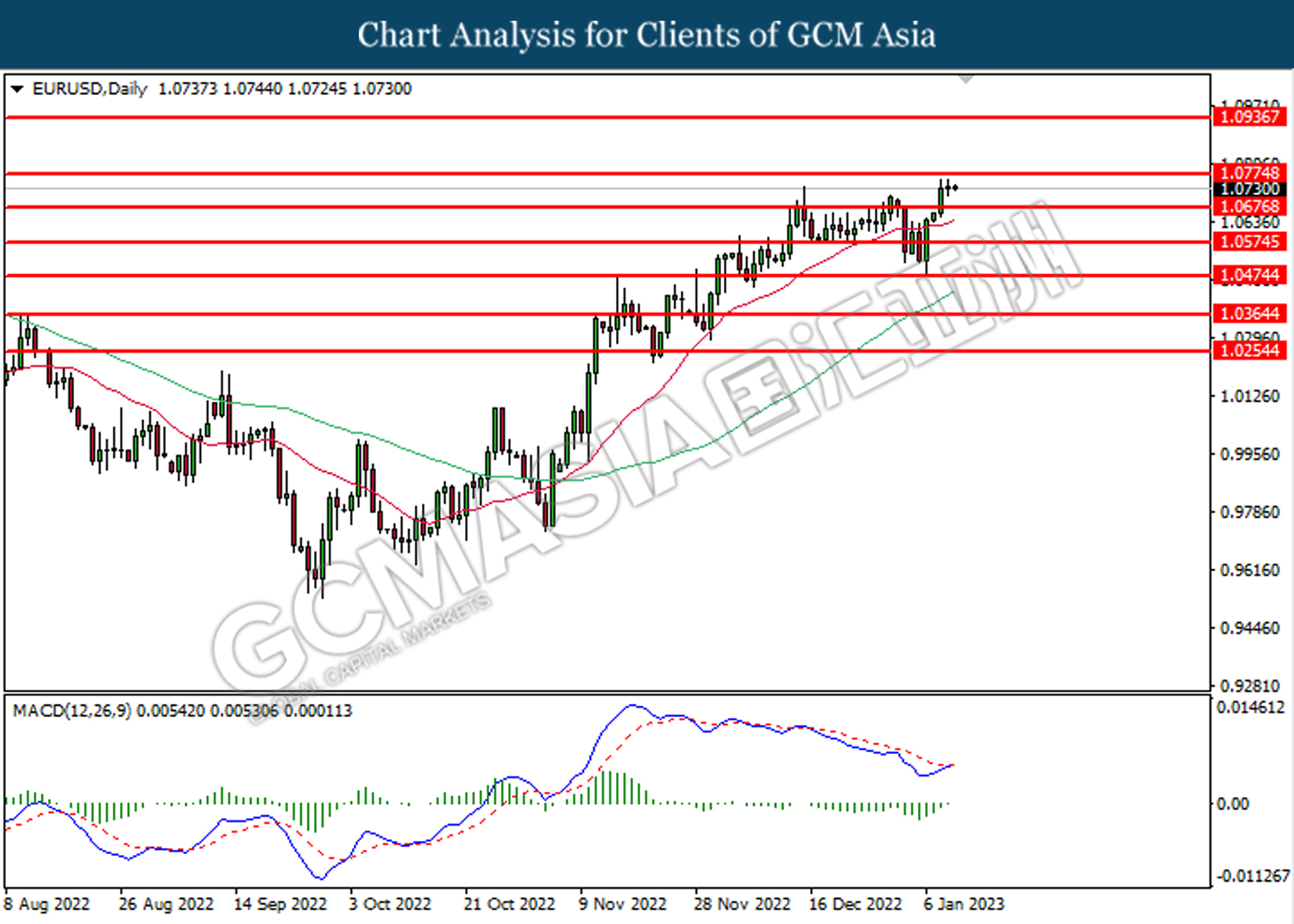

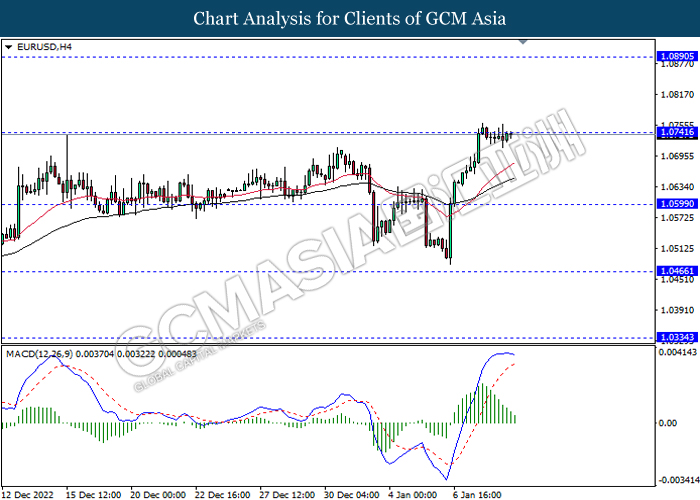

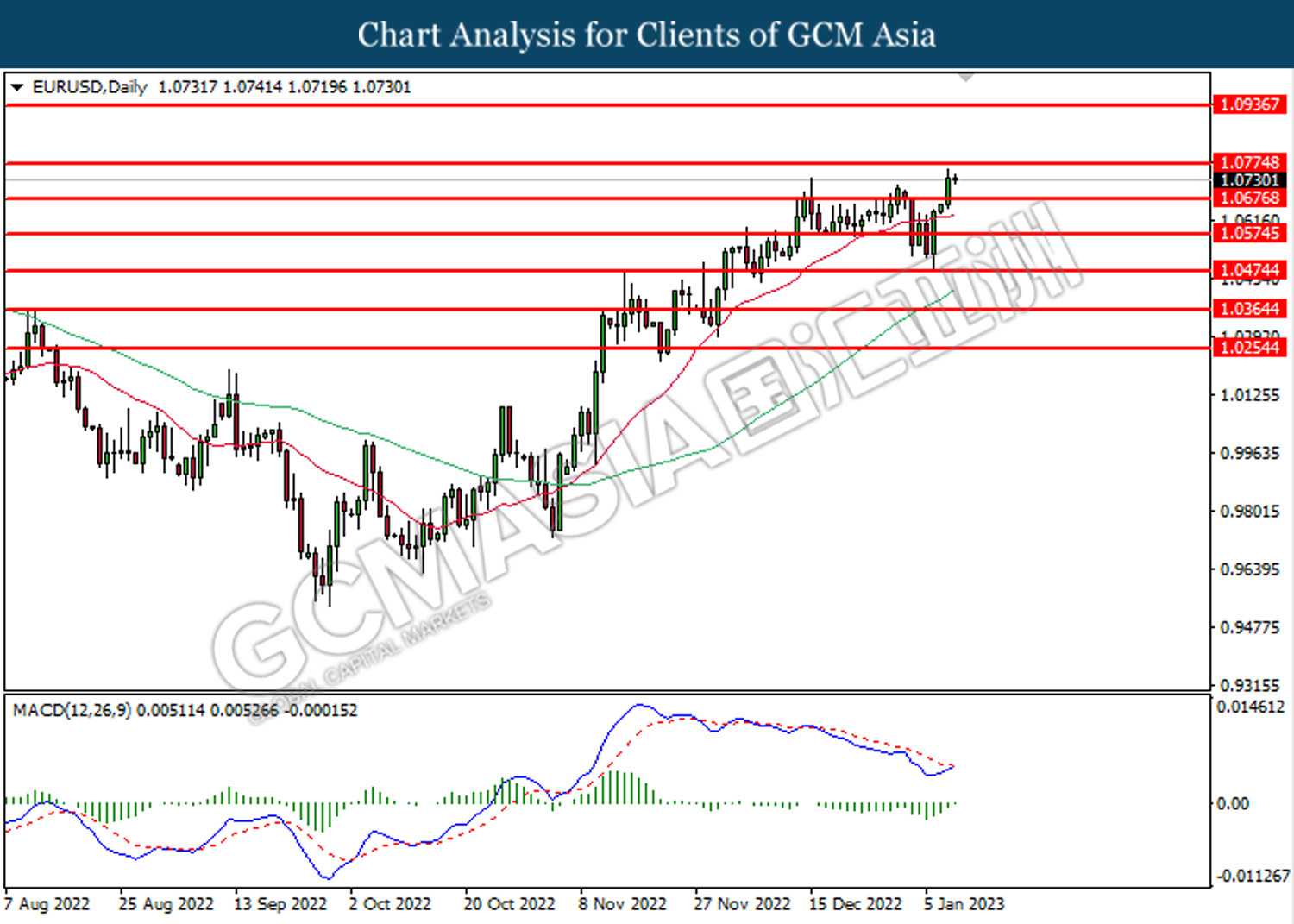

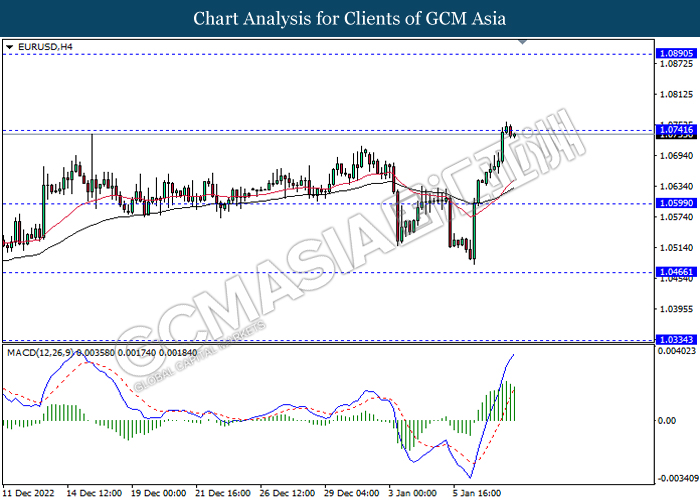

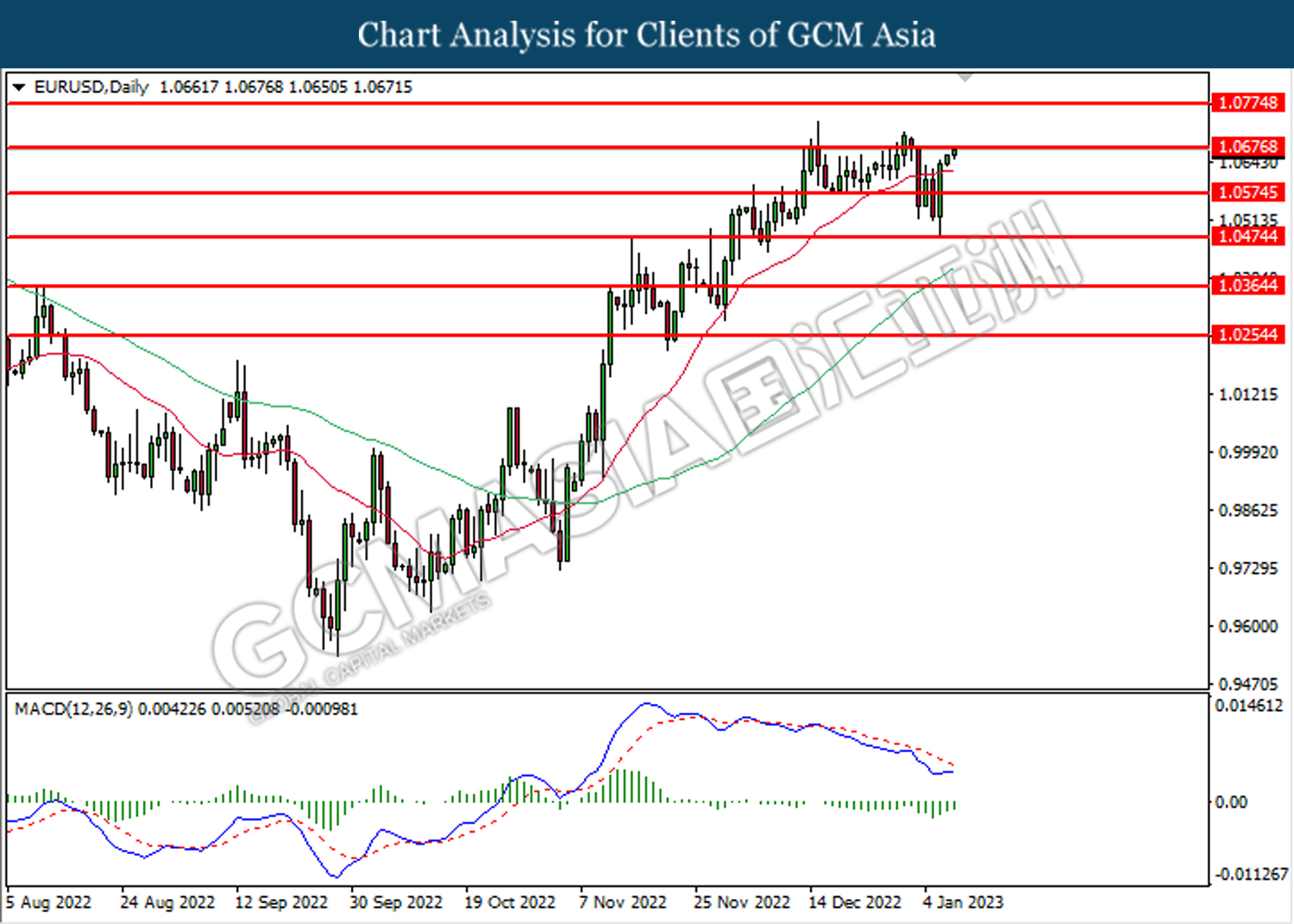

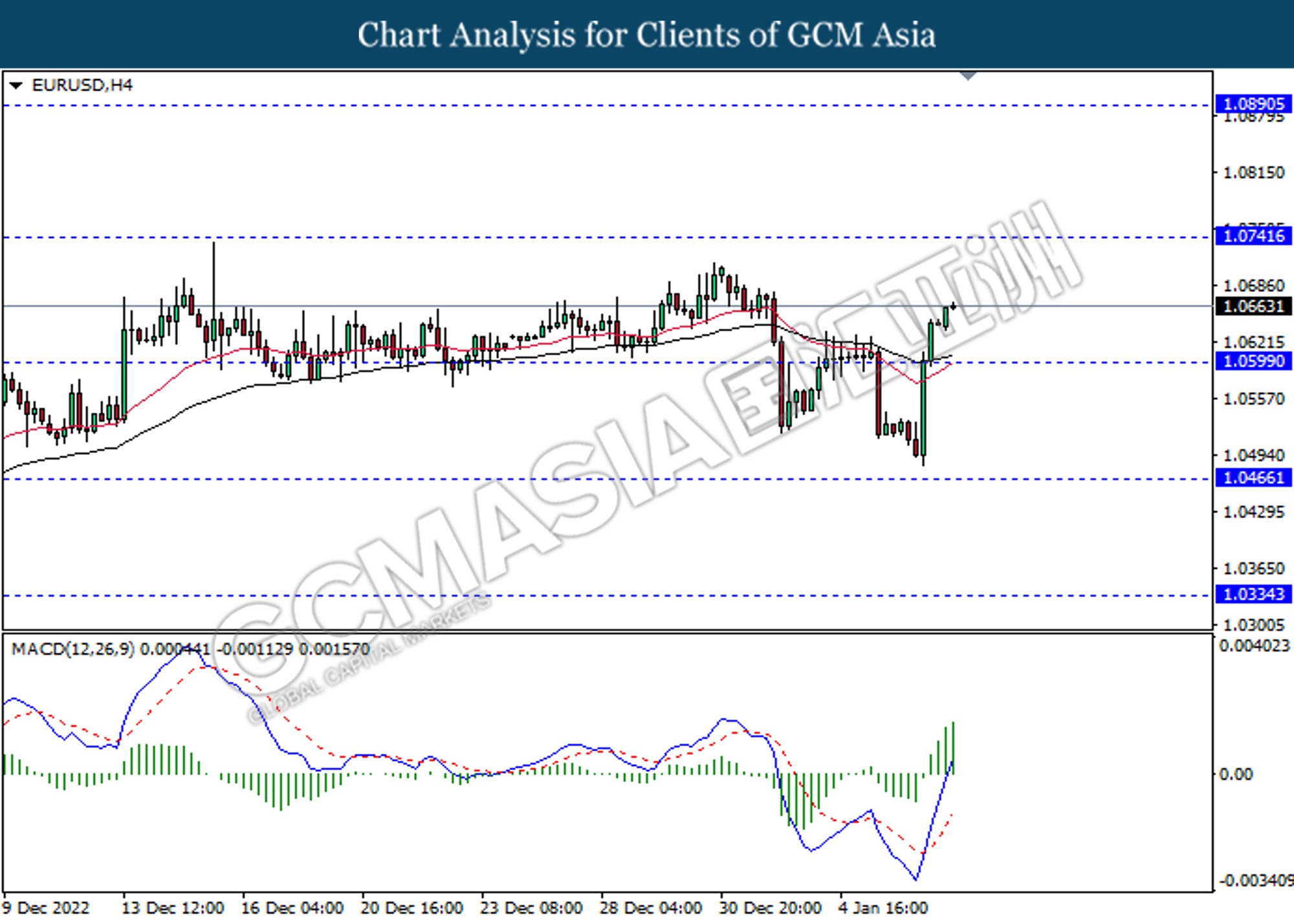

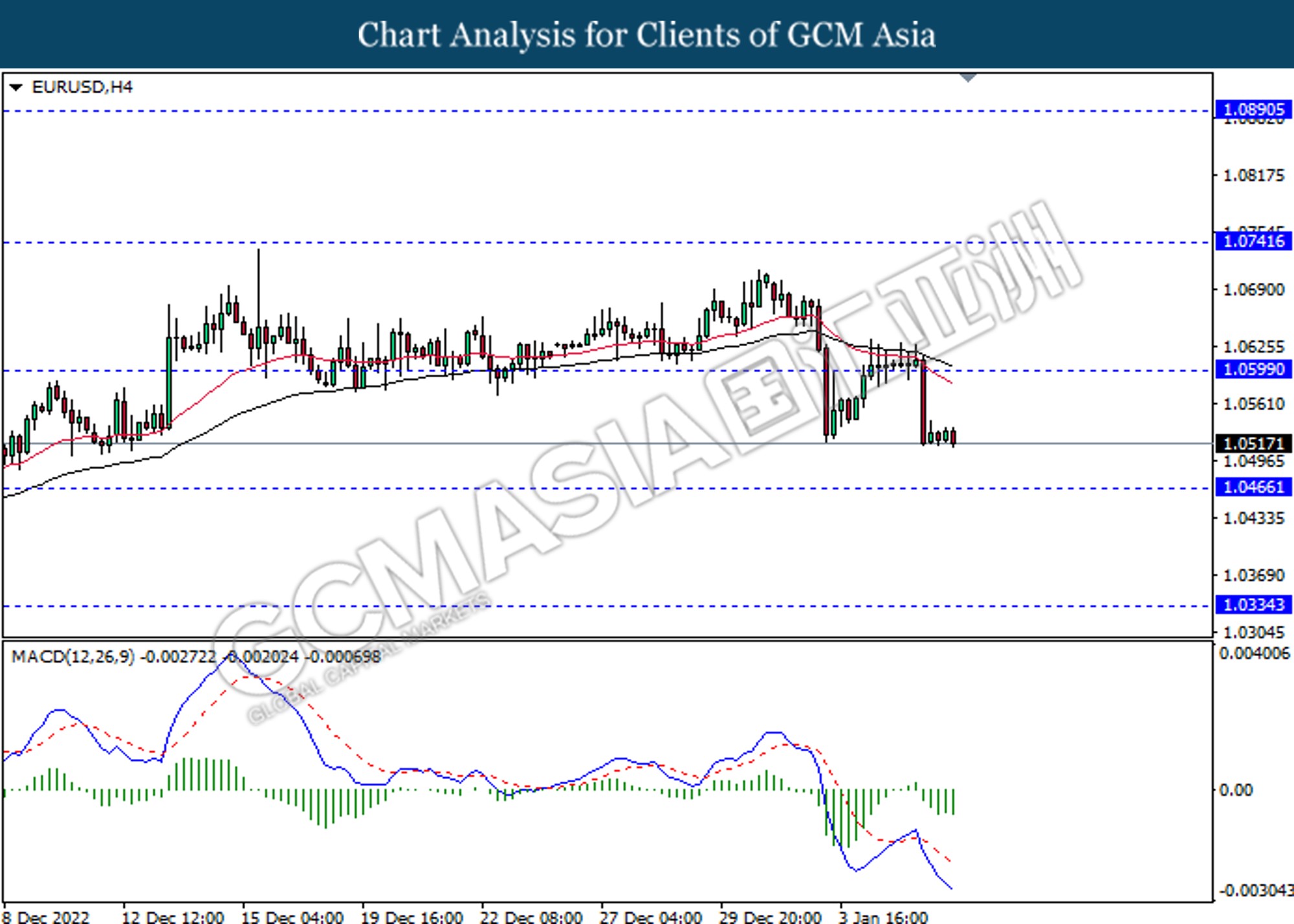

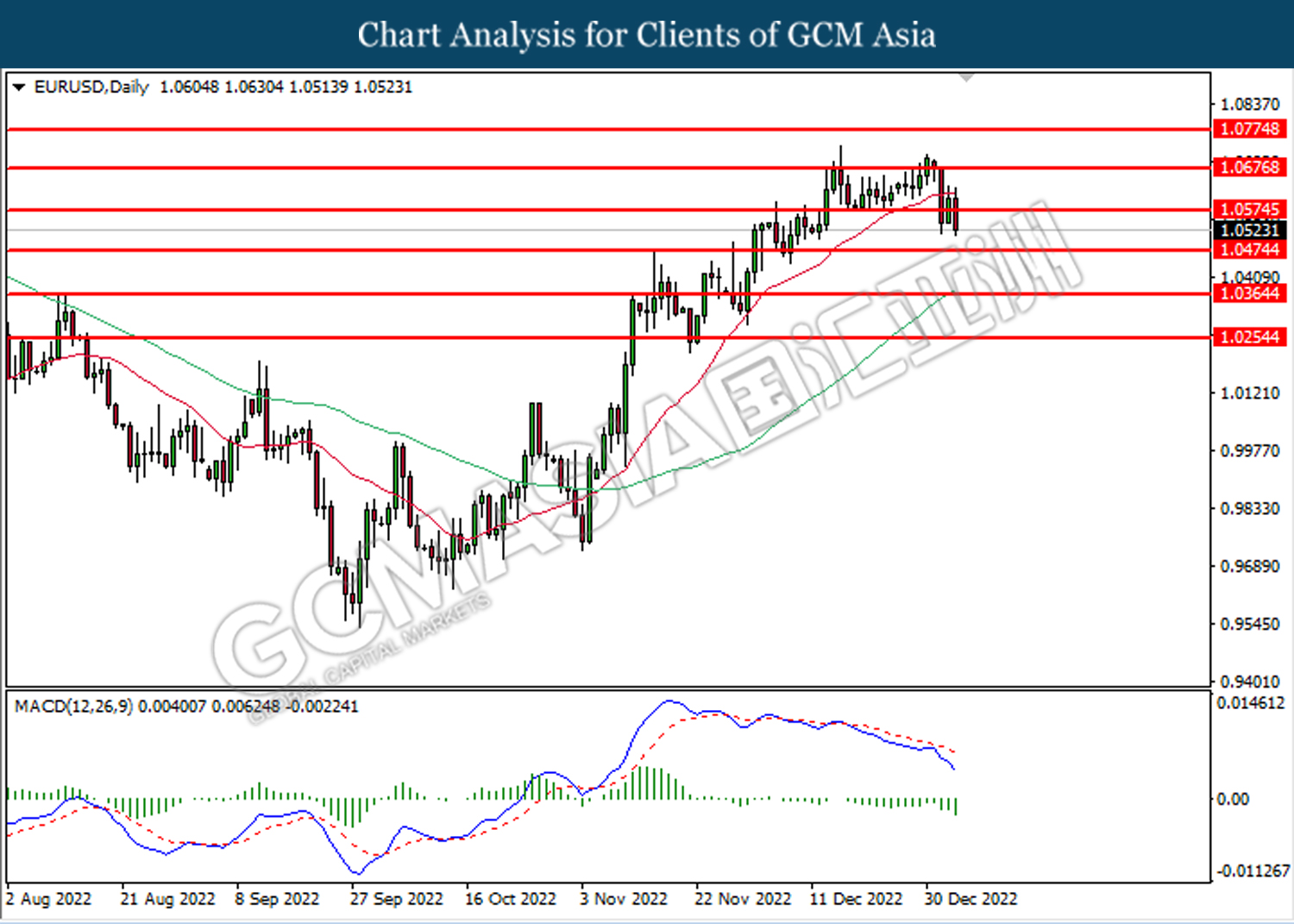

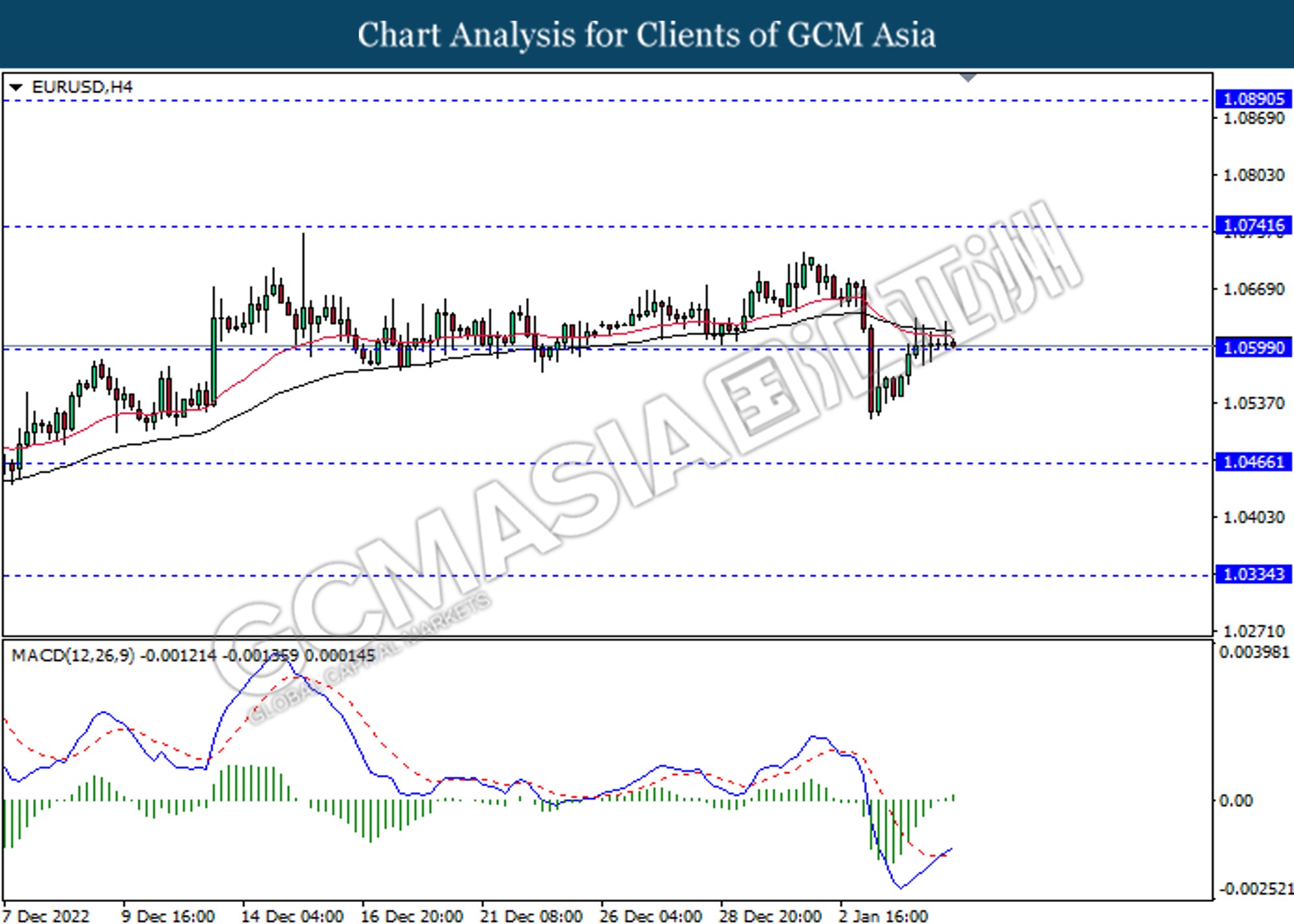

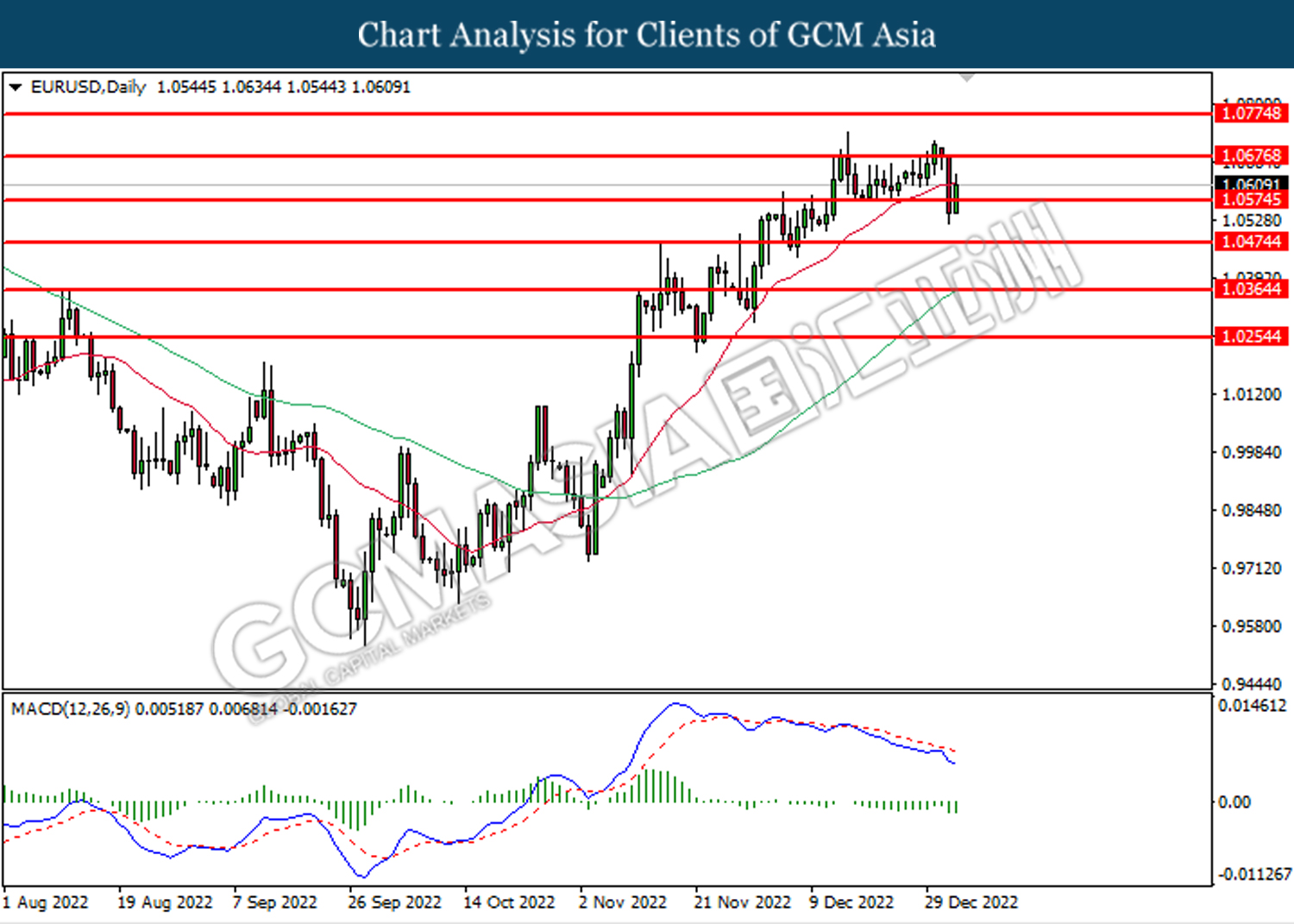

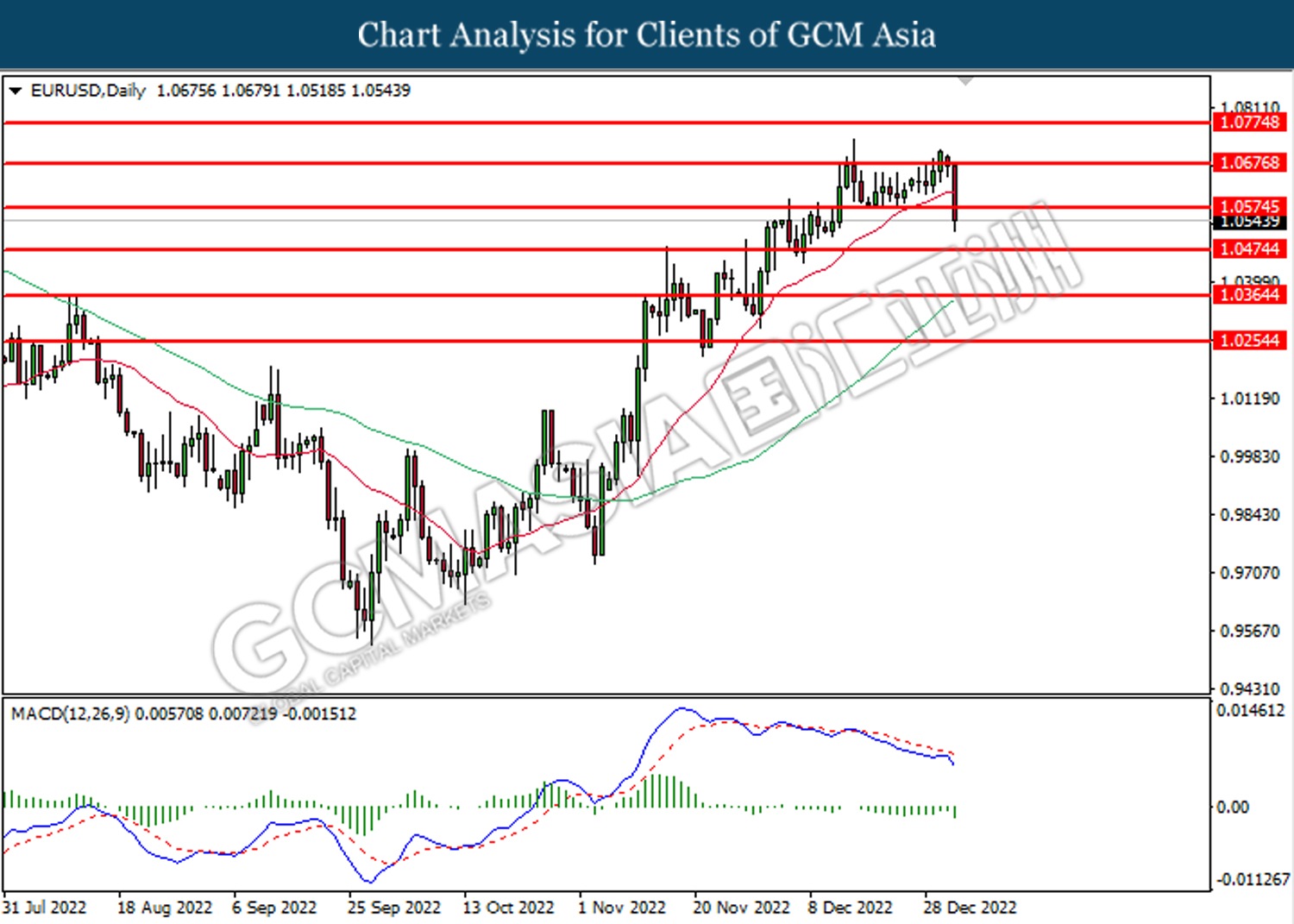

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0890, 1.1040

Support level: 1.0740, 1.0600

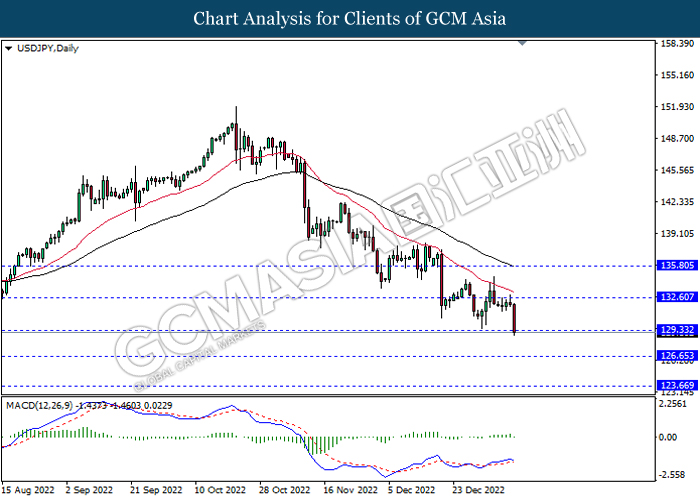

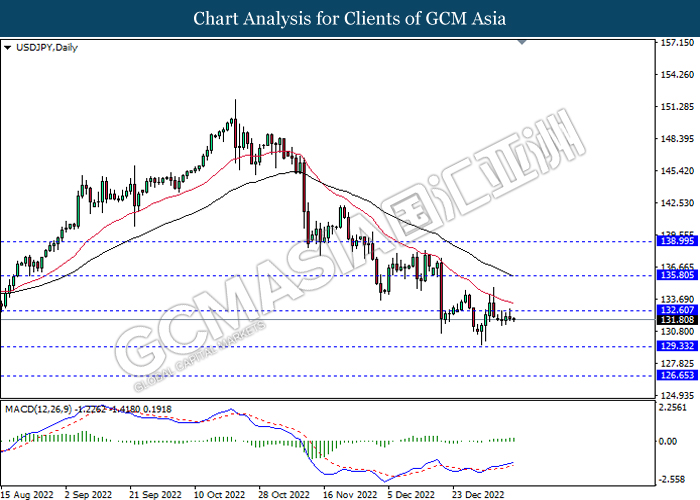

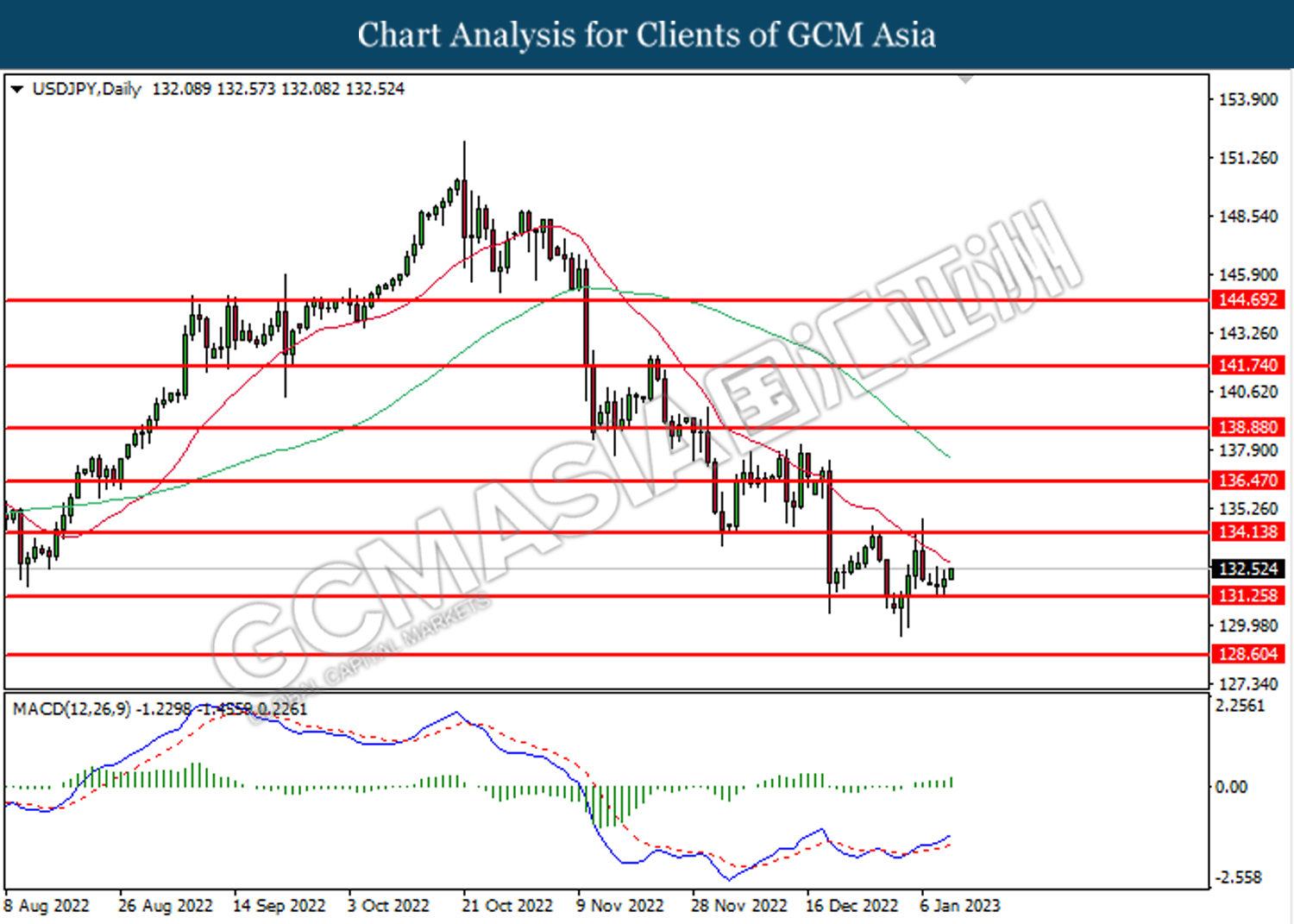

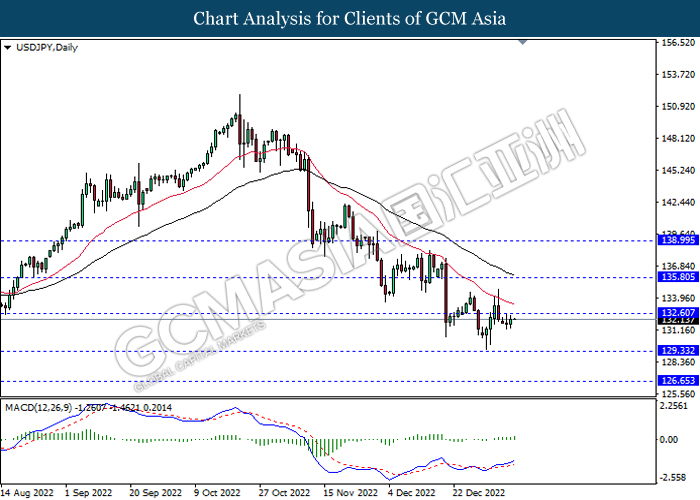

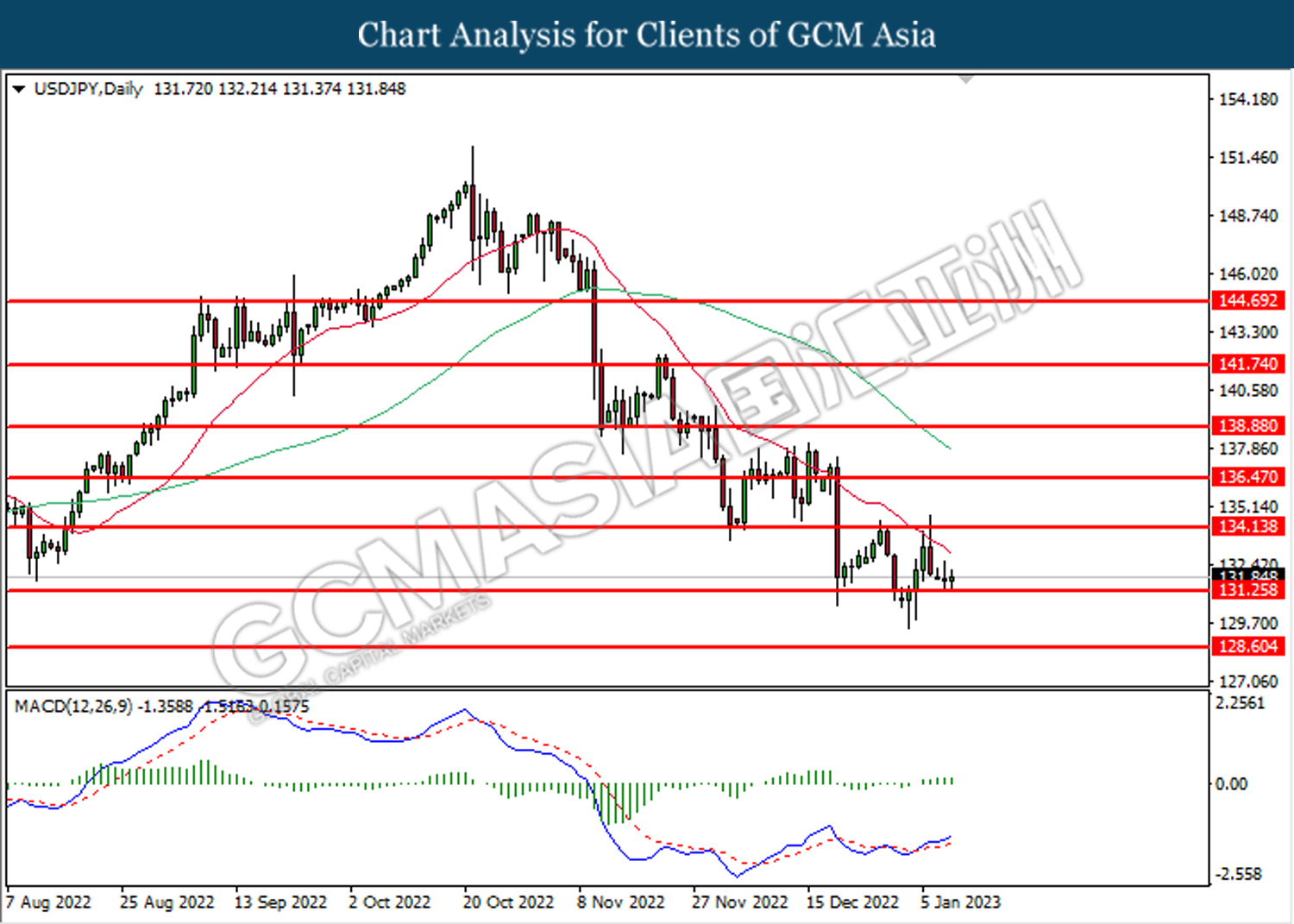

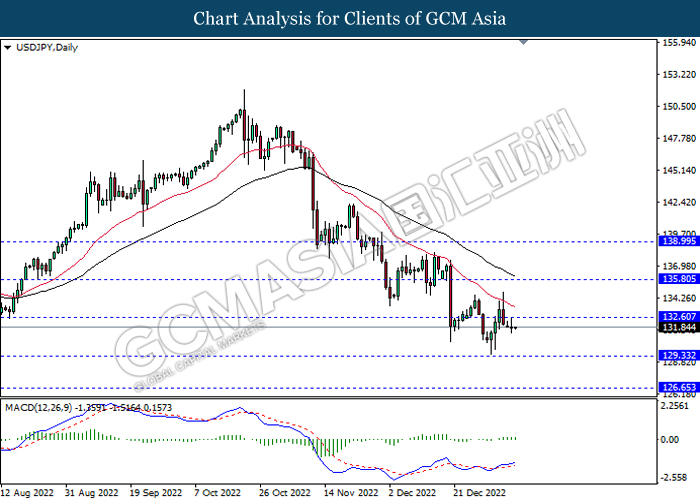

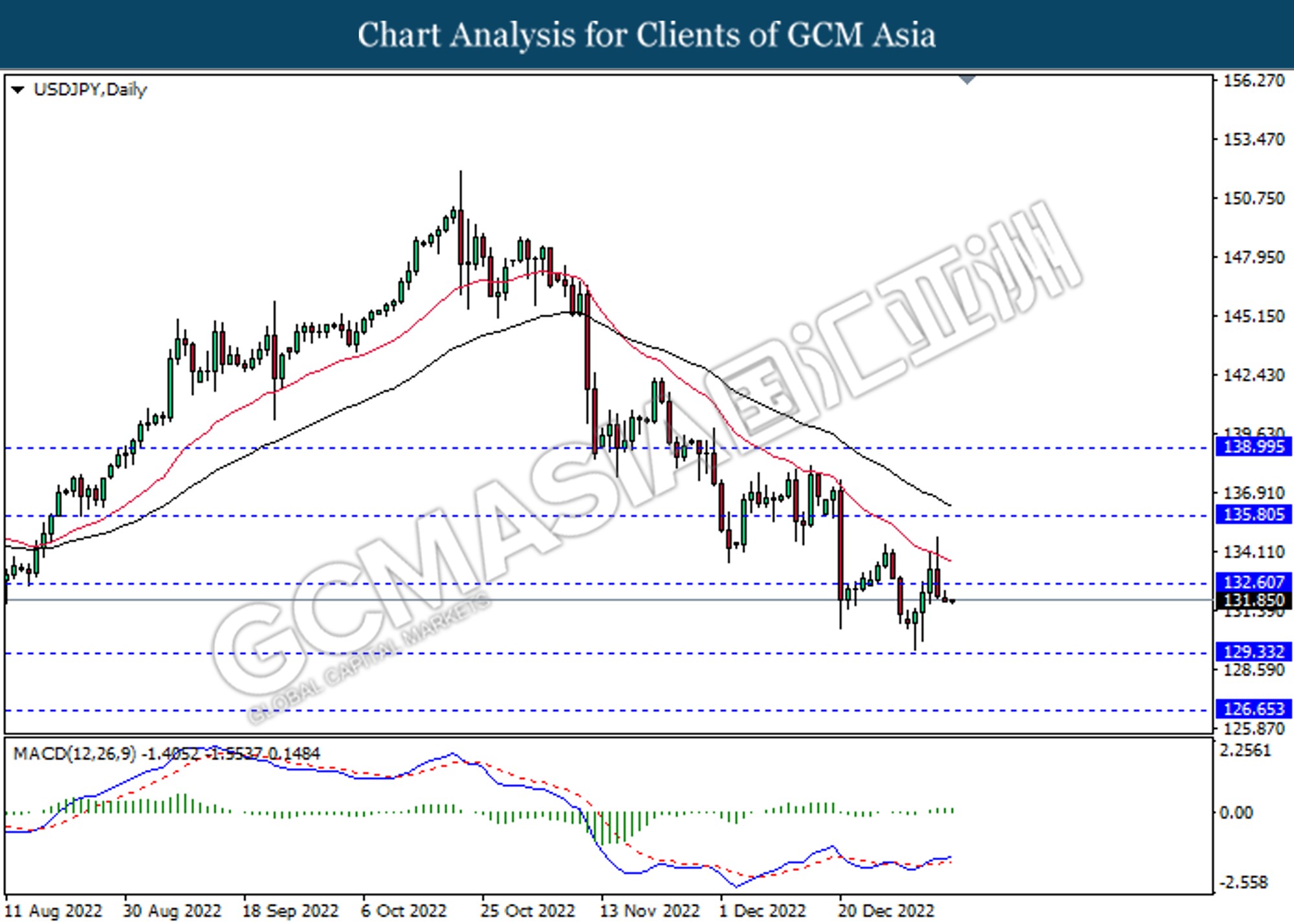

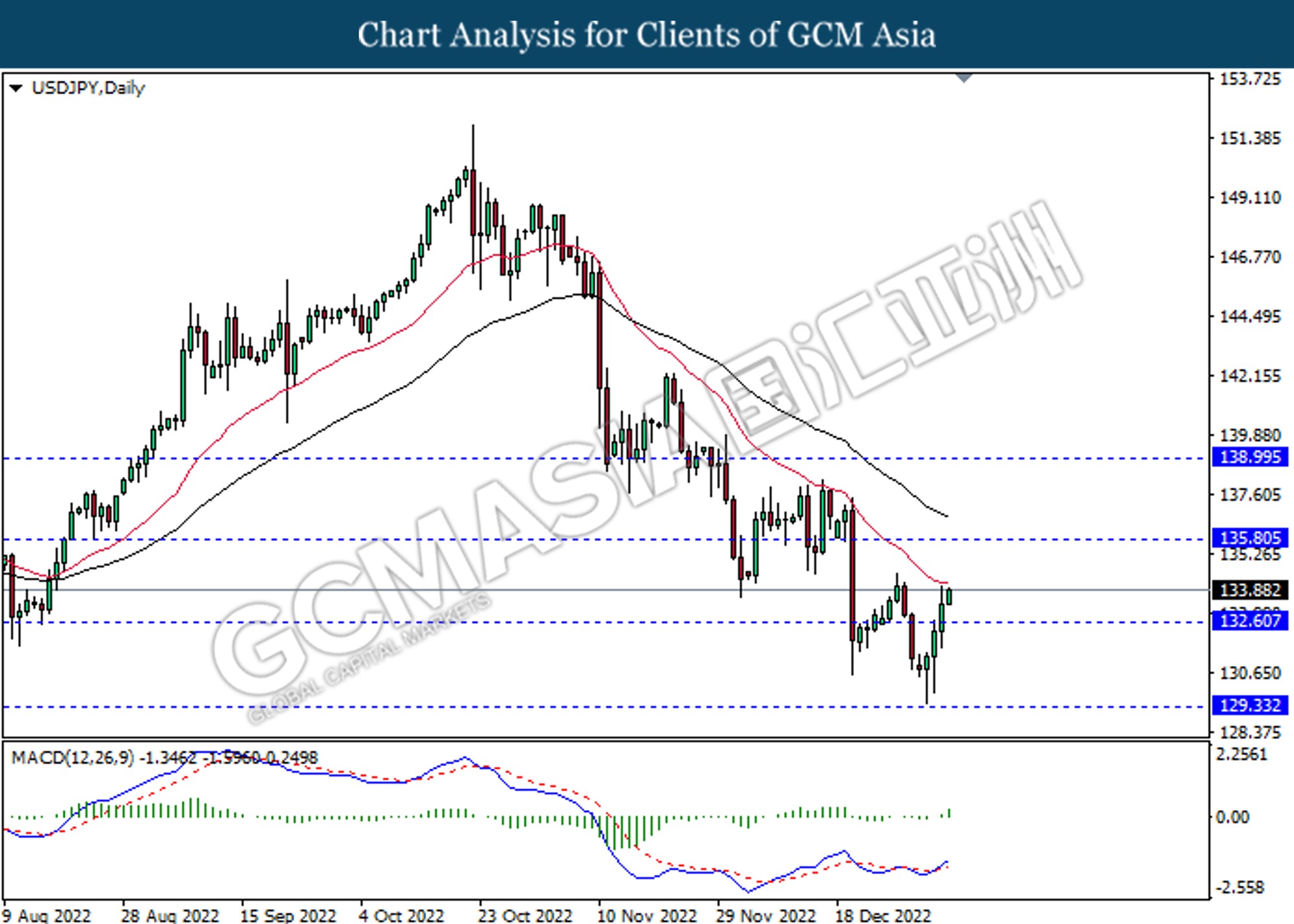

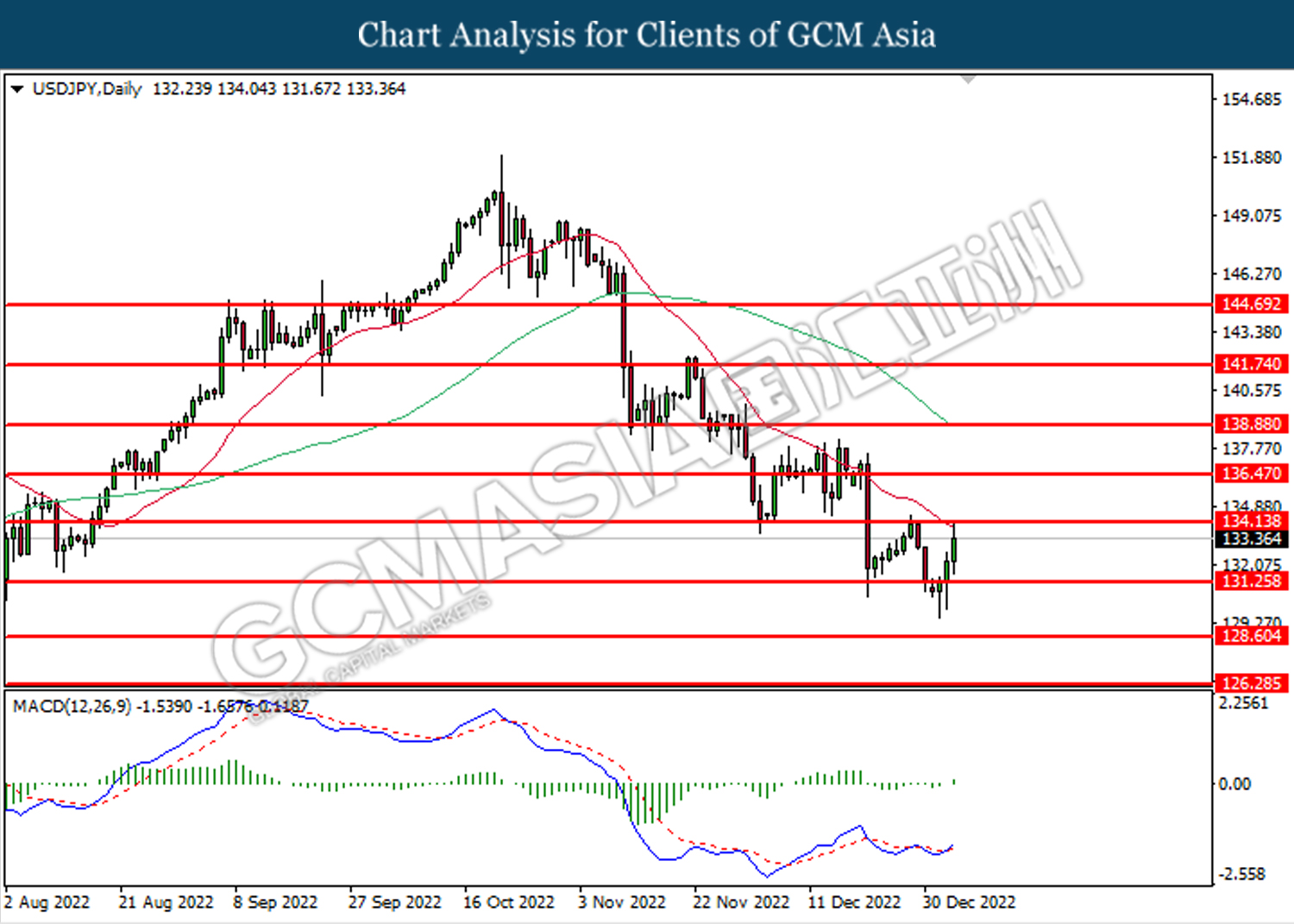

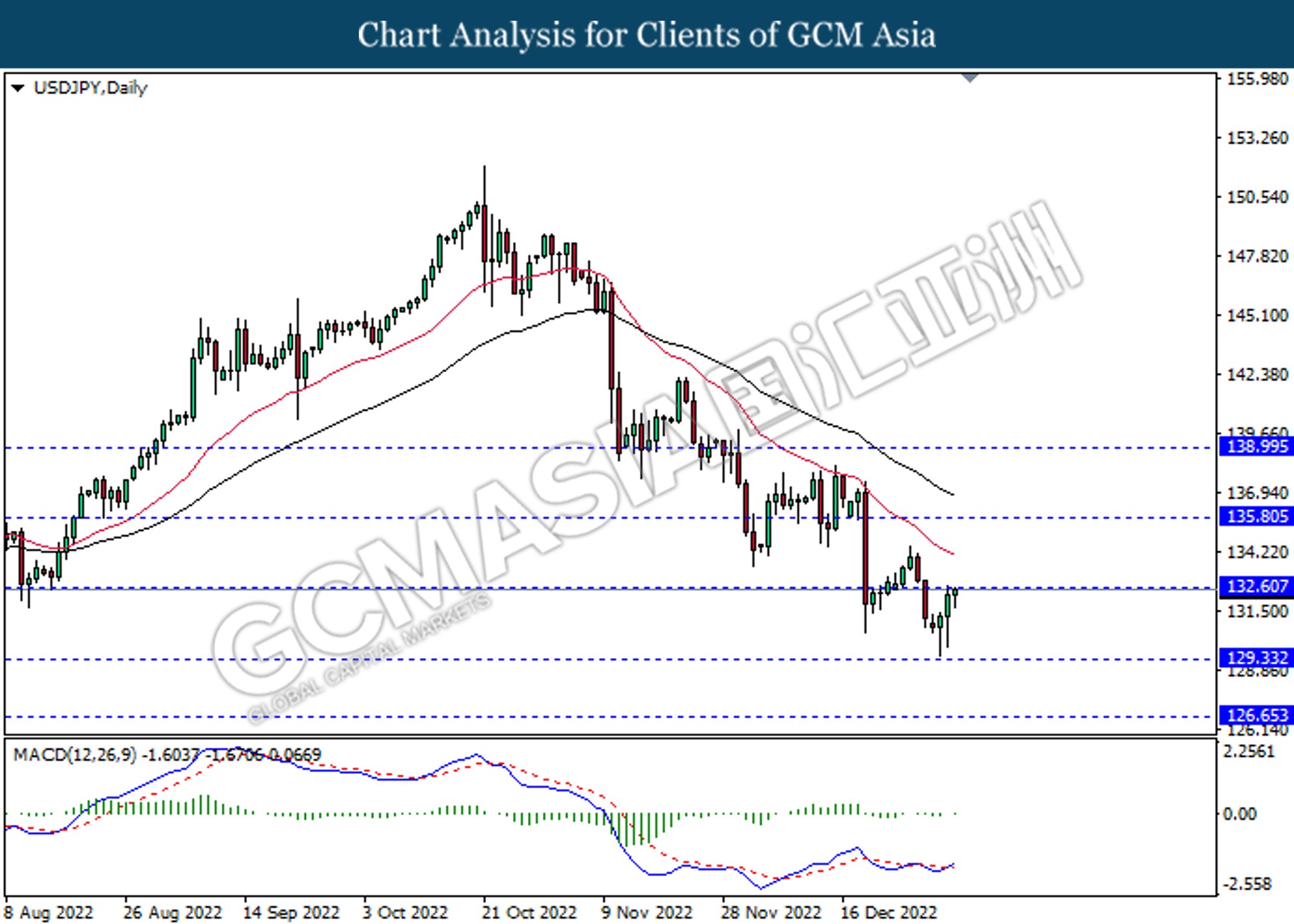

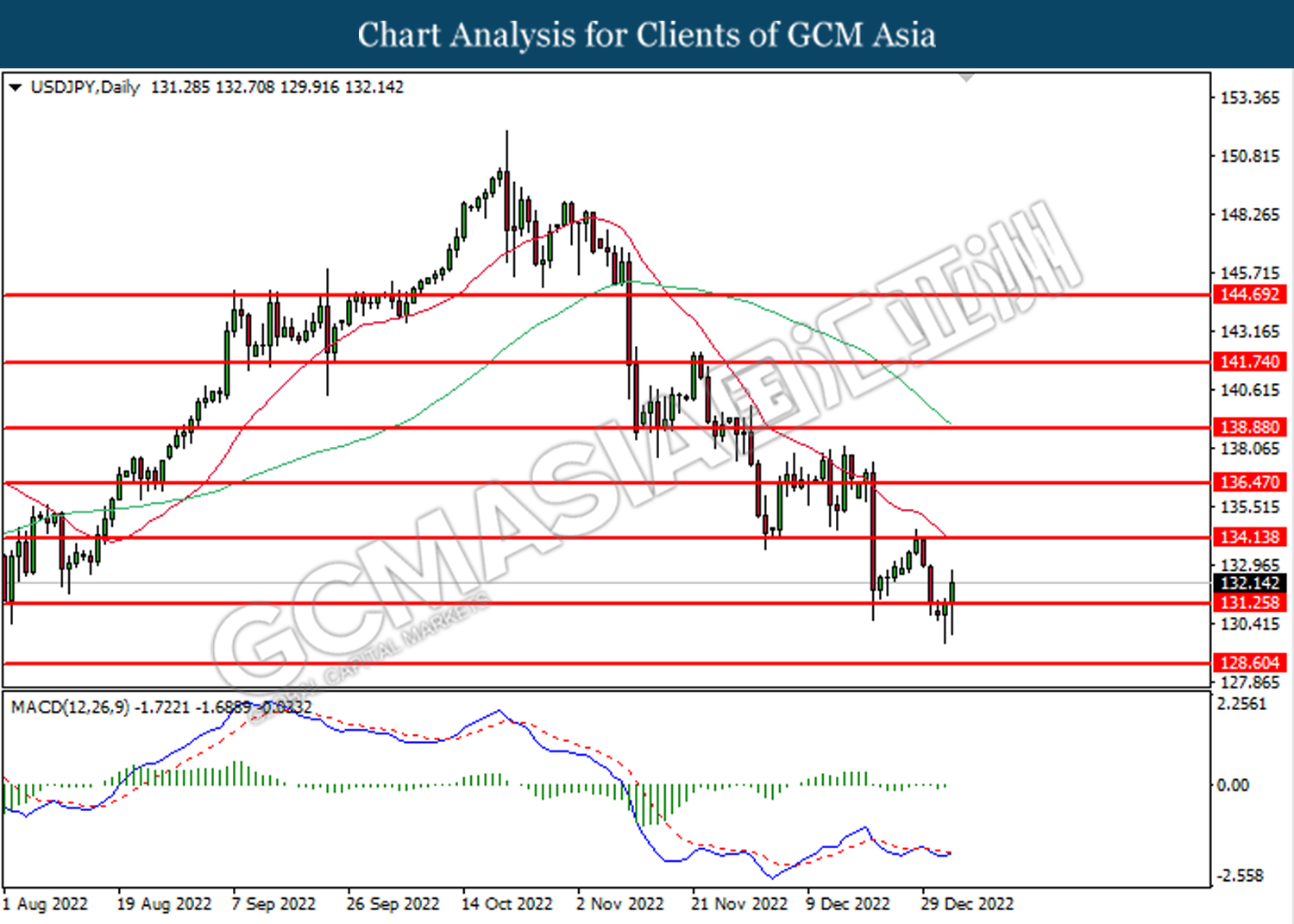

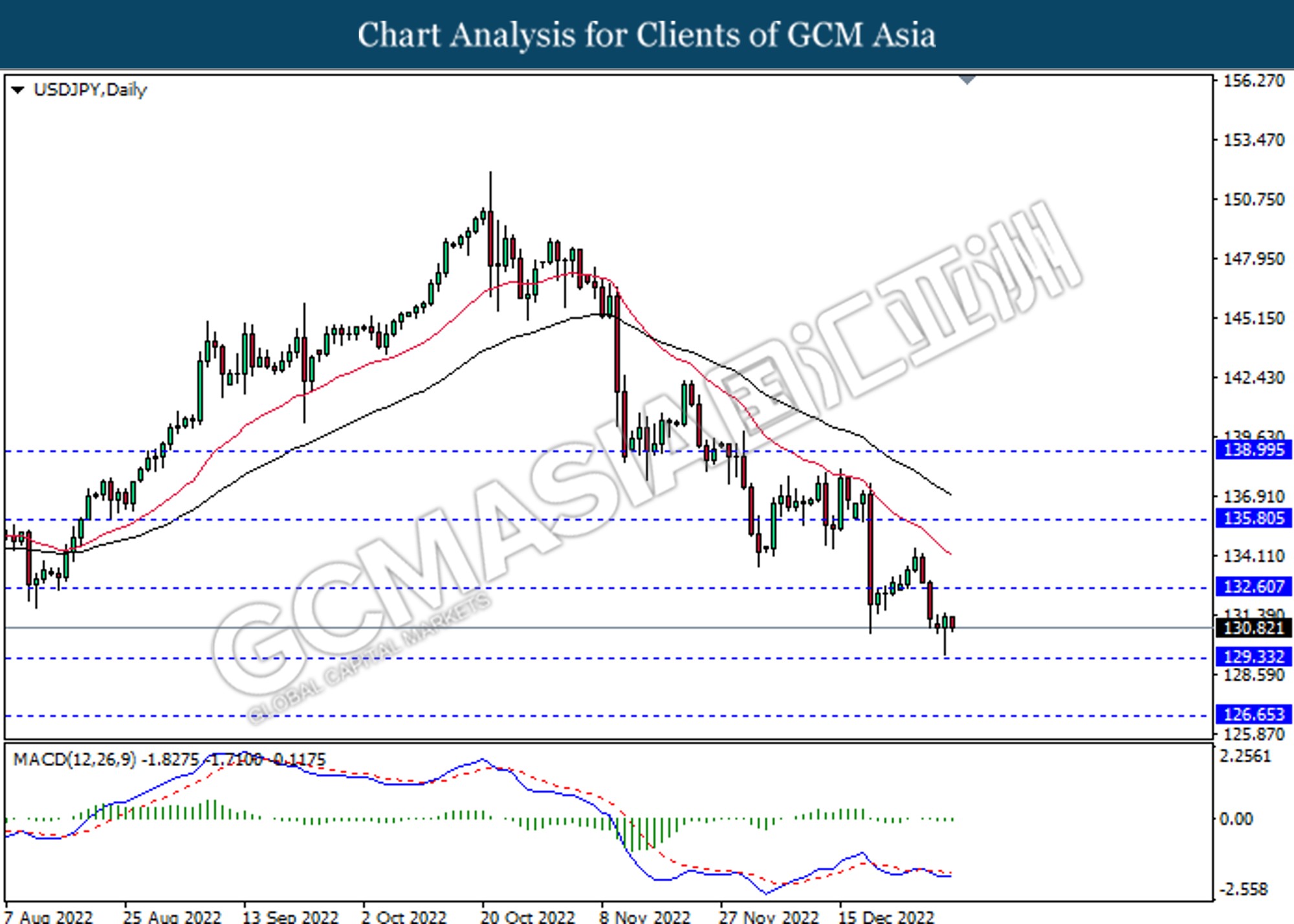

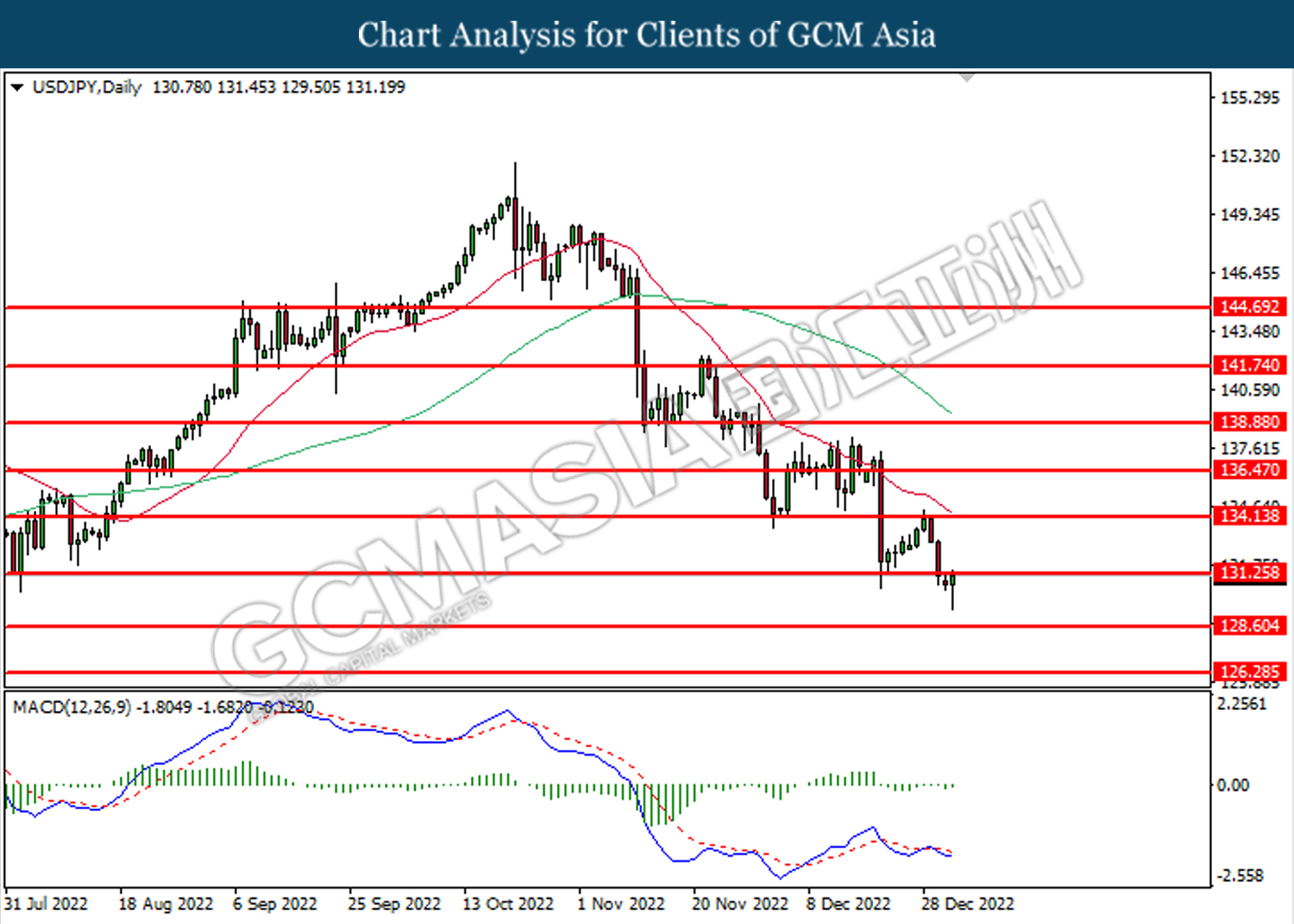

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 129.35, 132.60

Support level: 126.65, 123.65

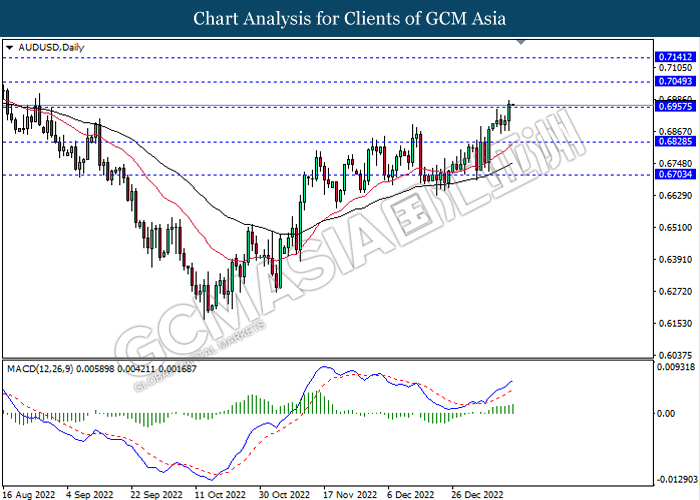

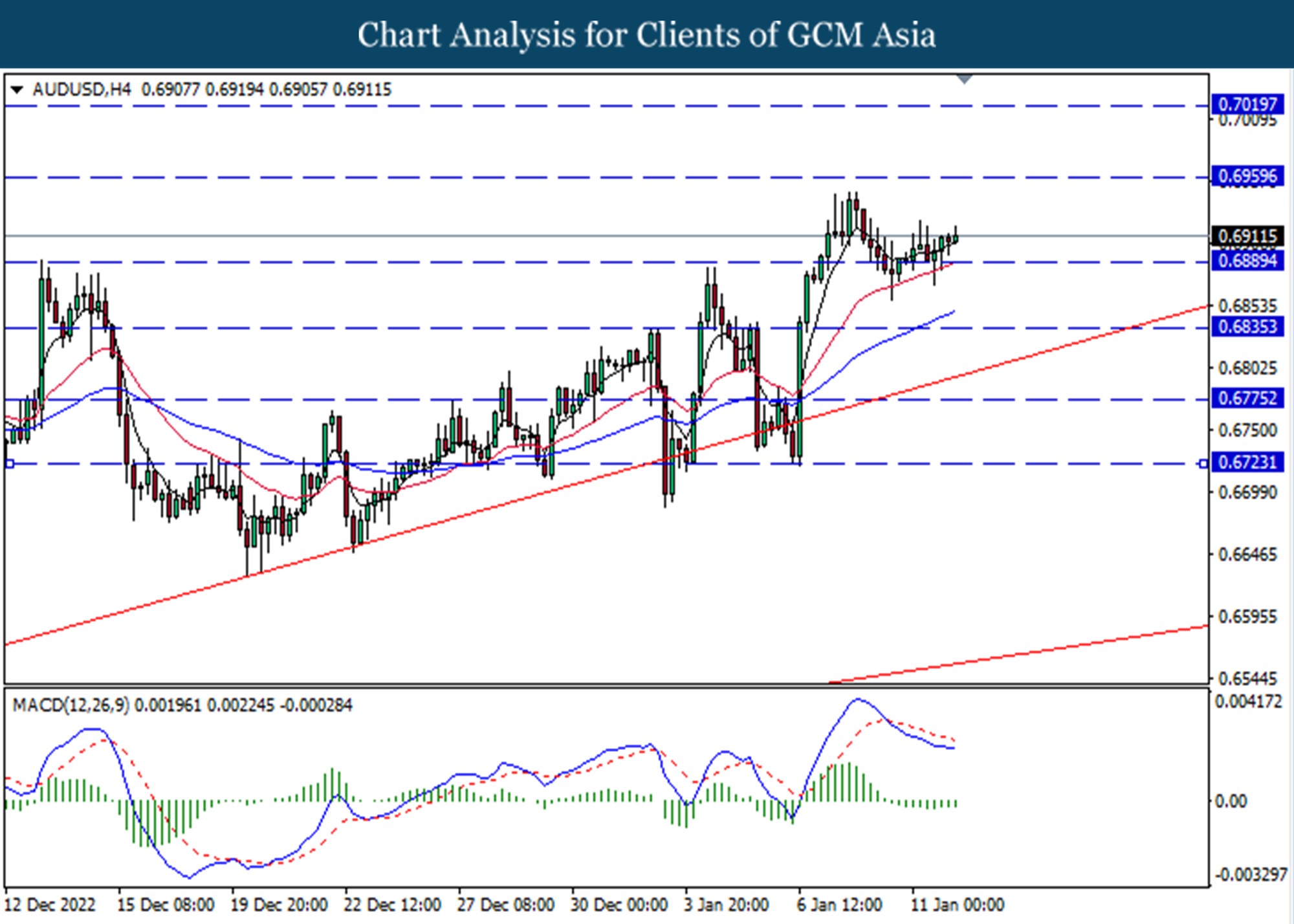

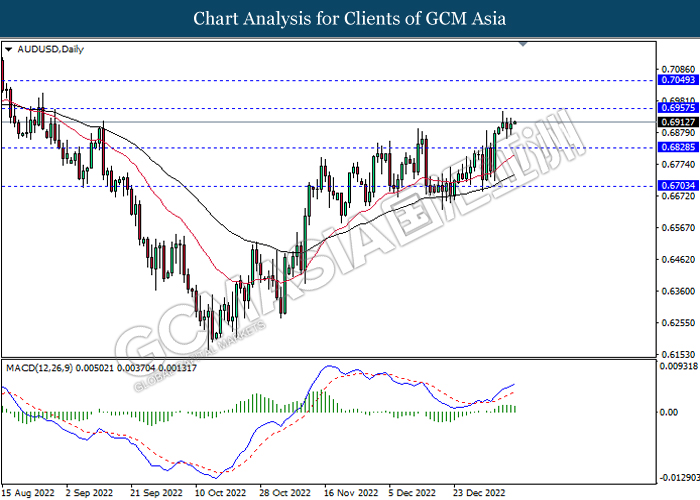

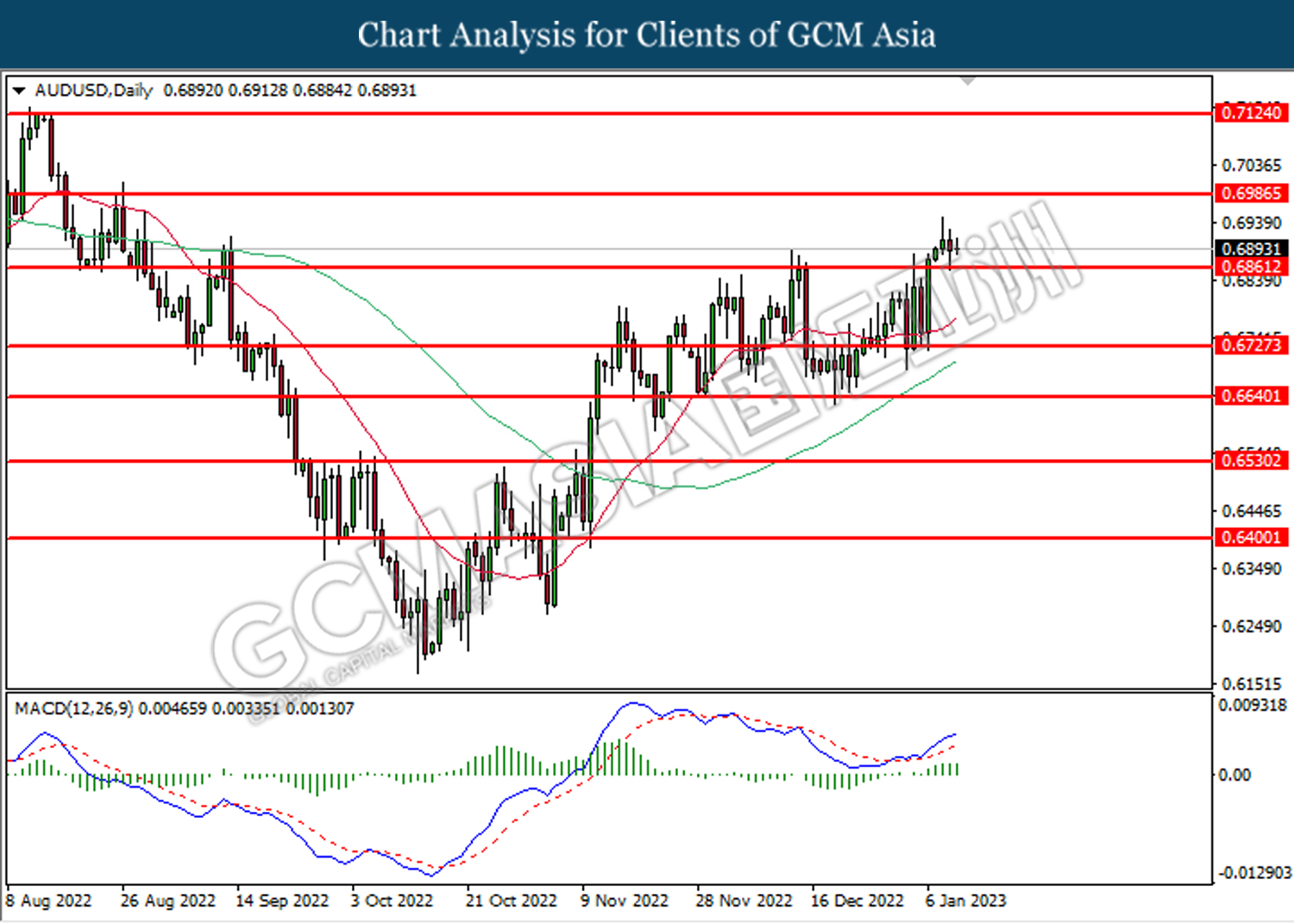

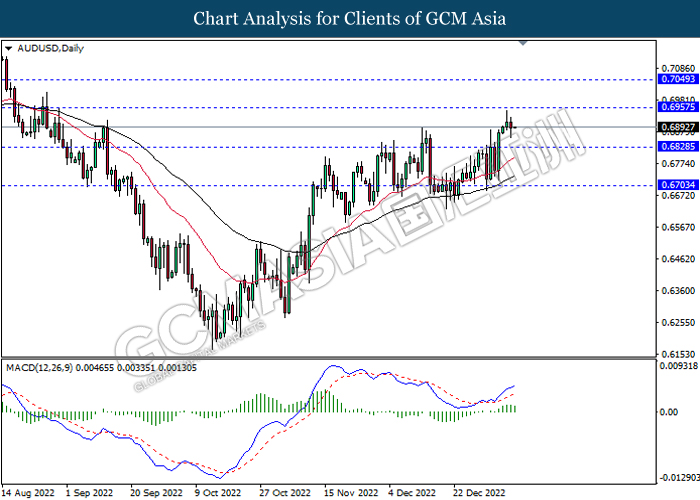

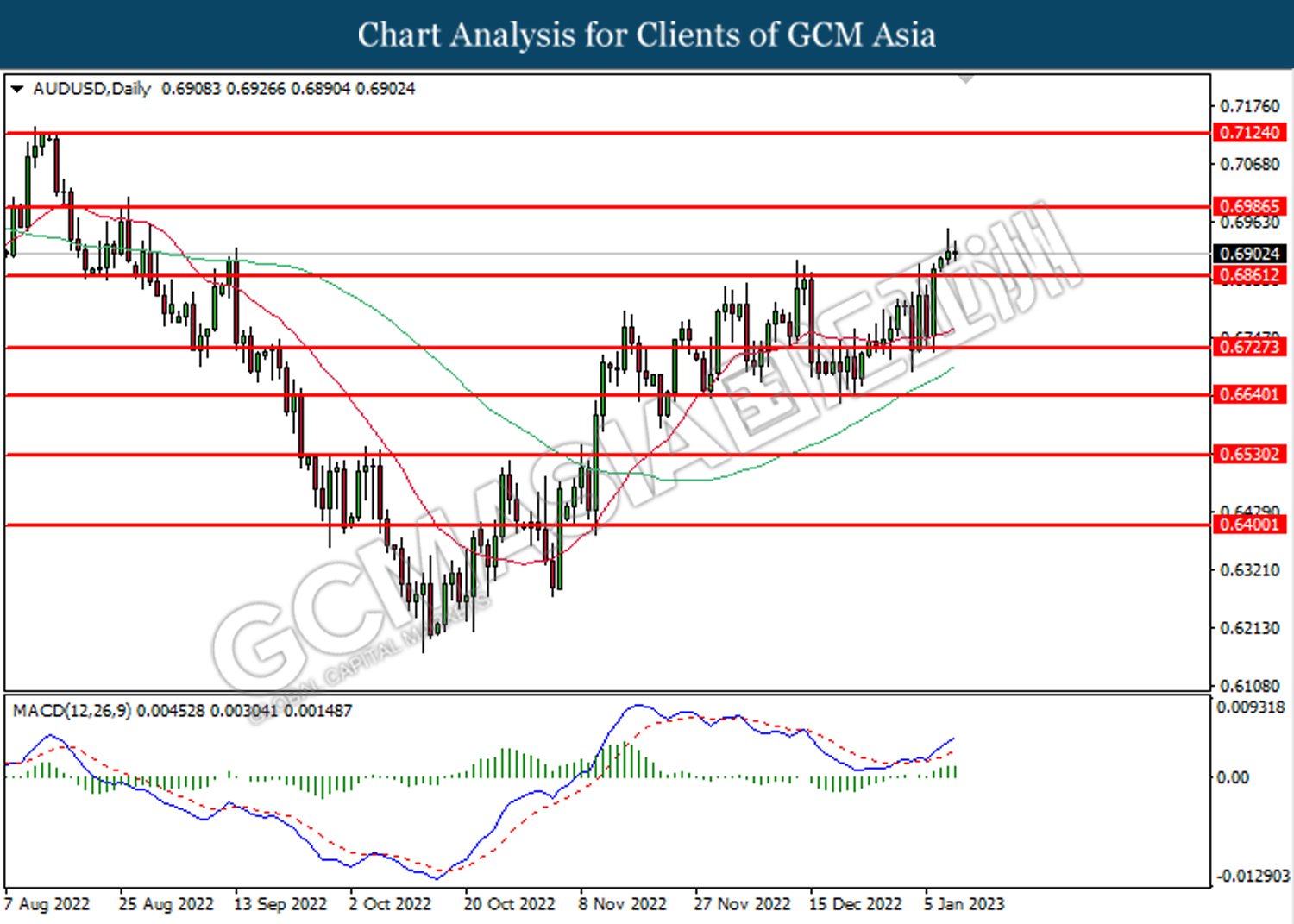

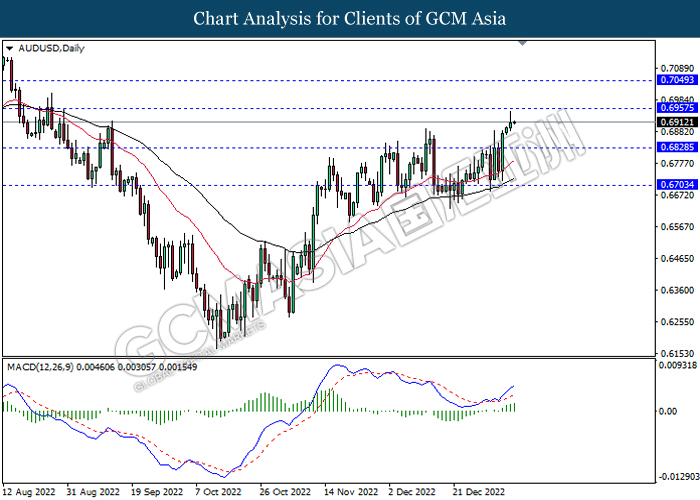

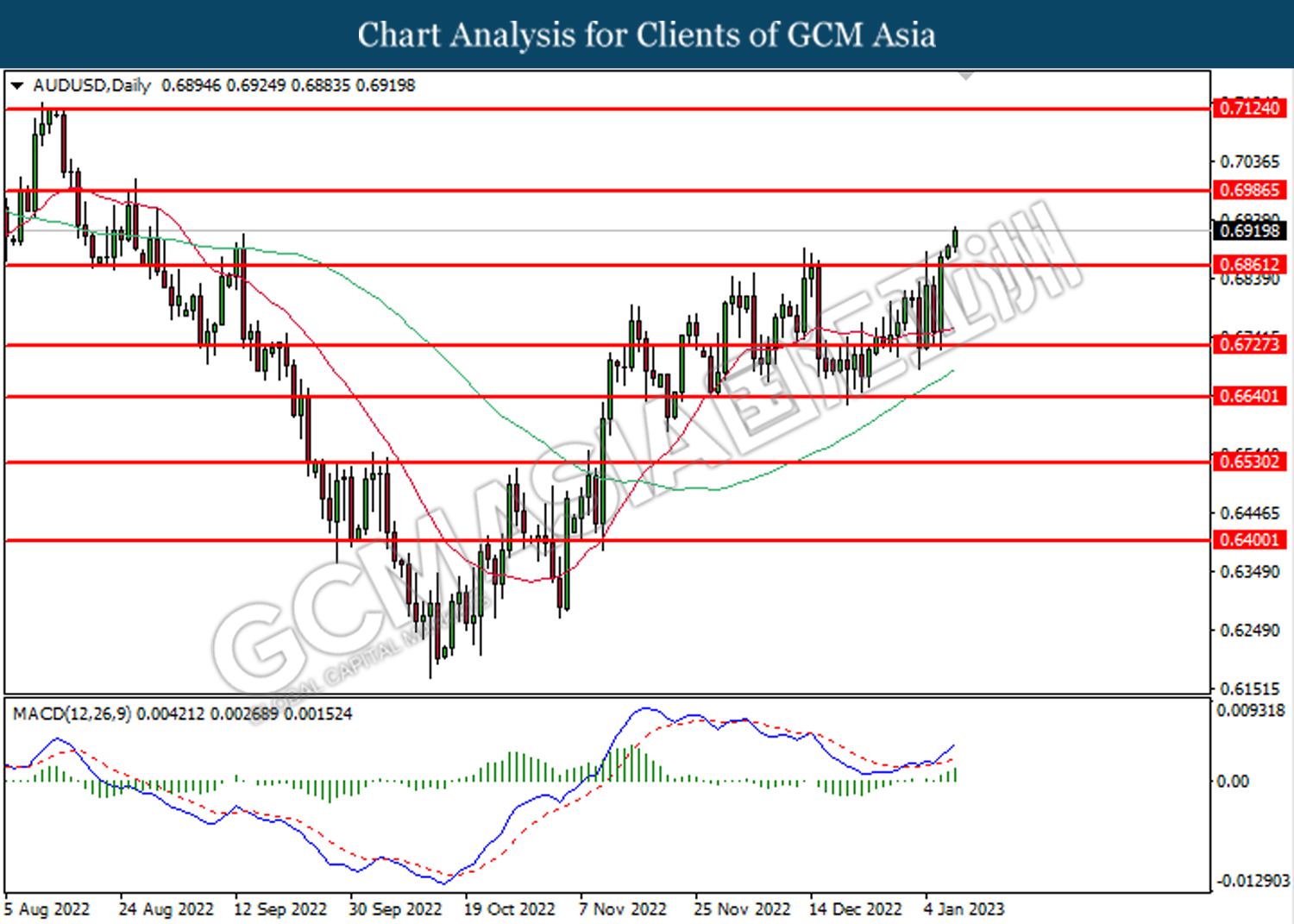

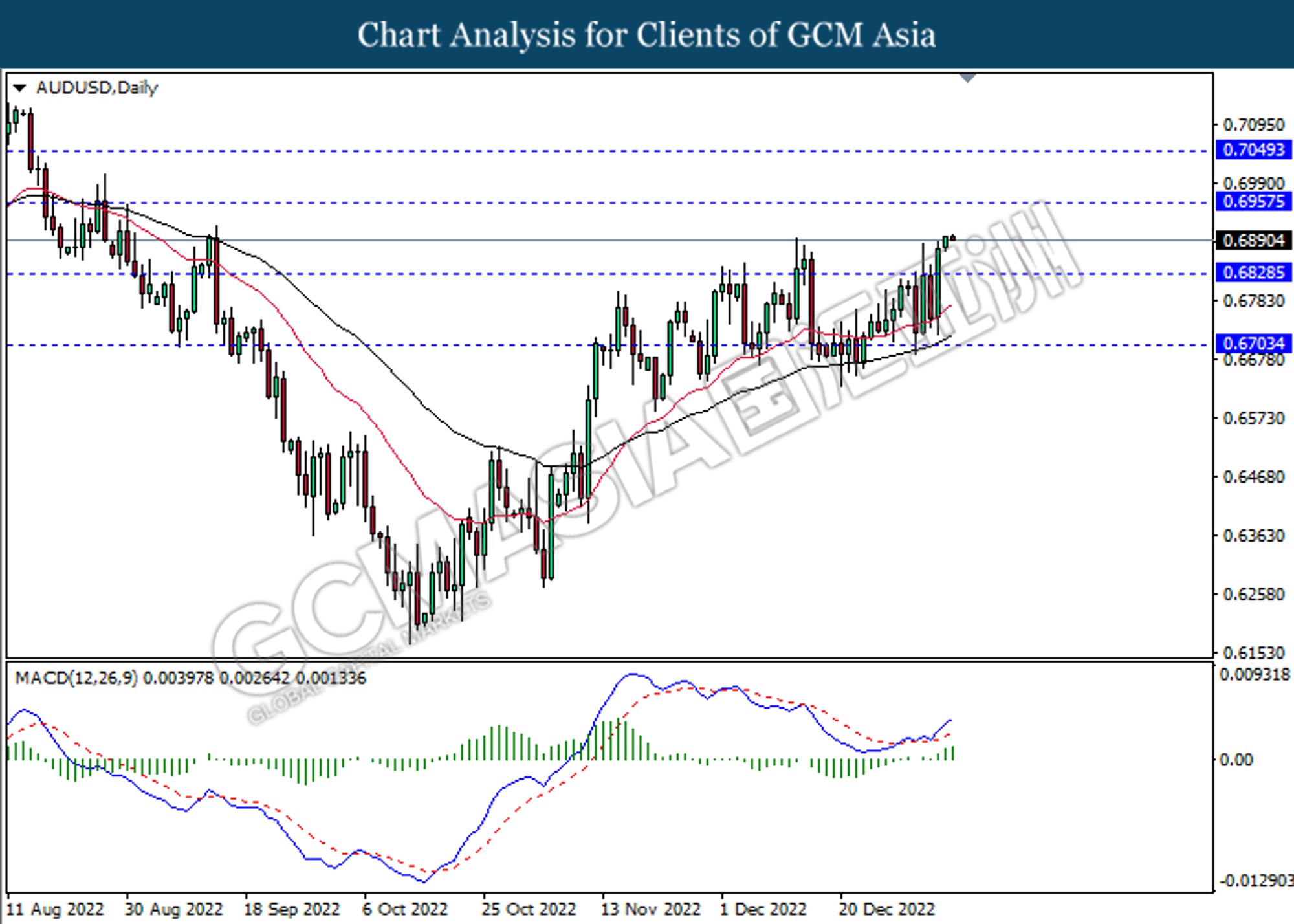

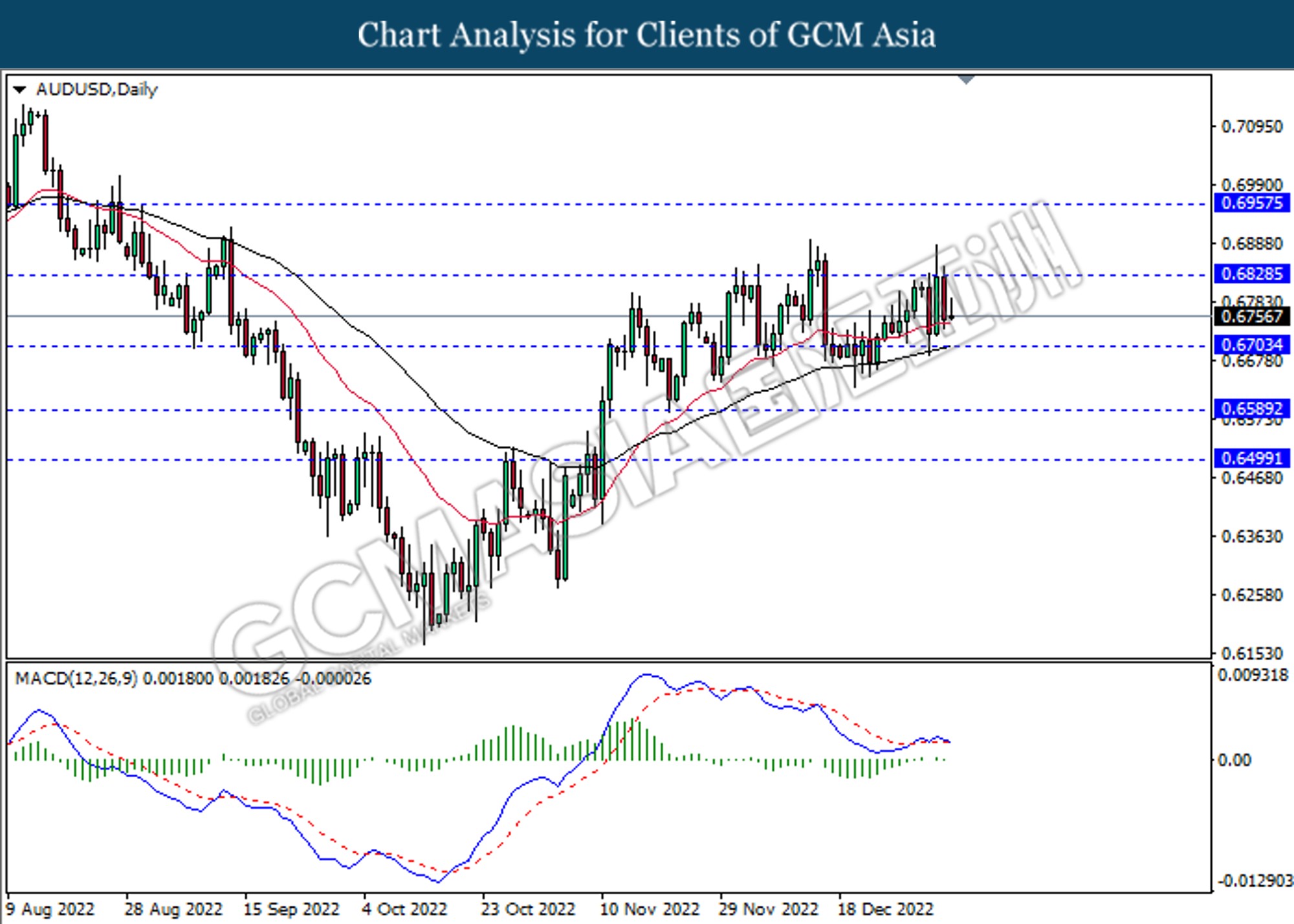

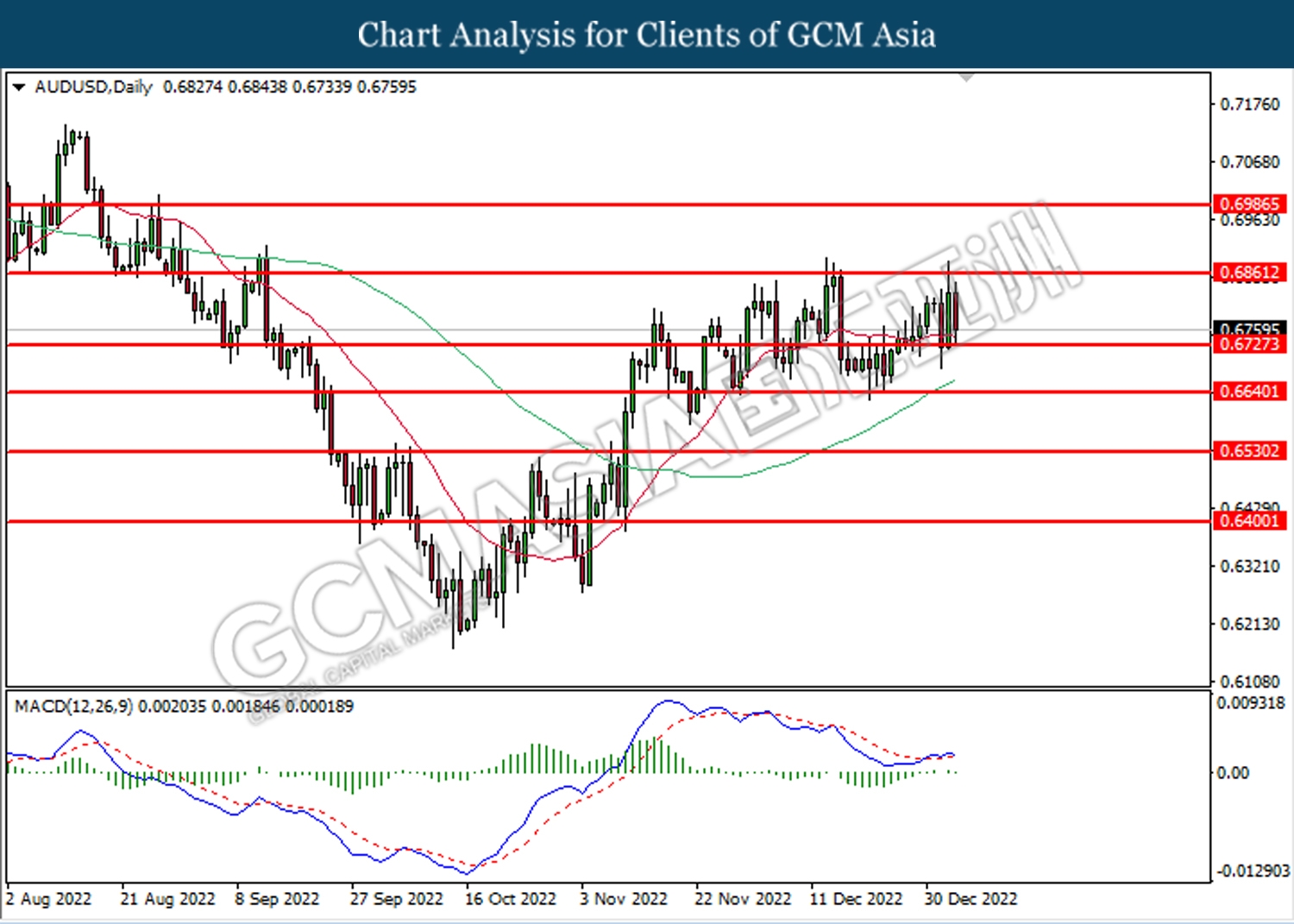

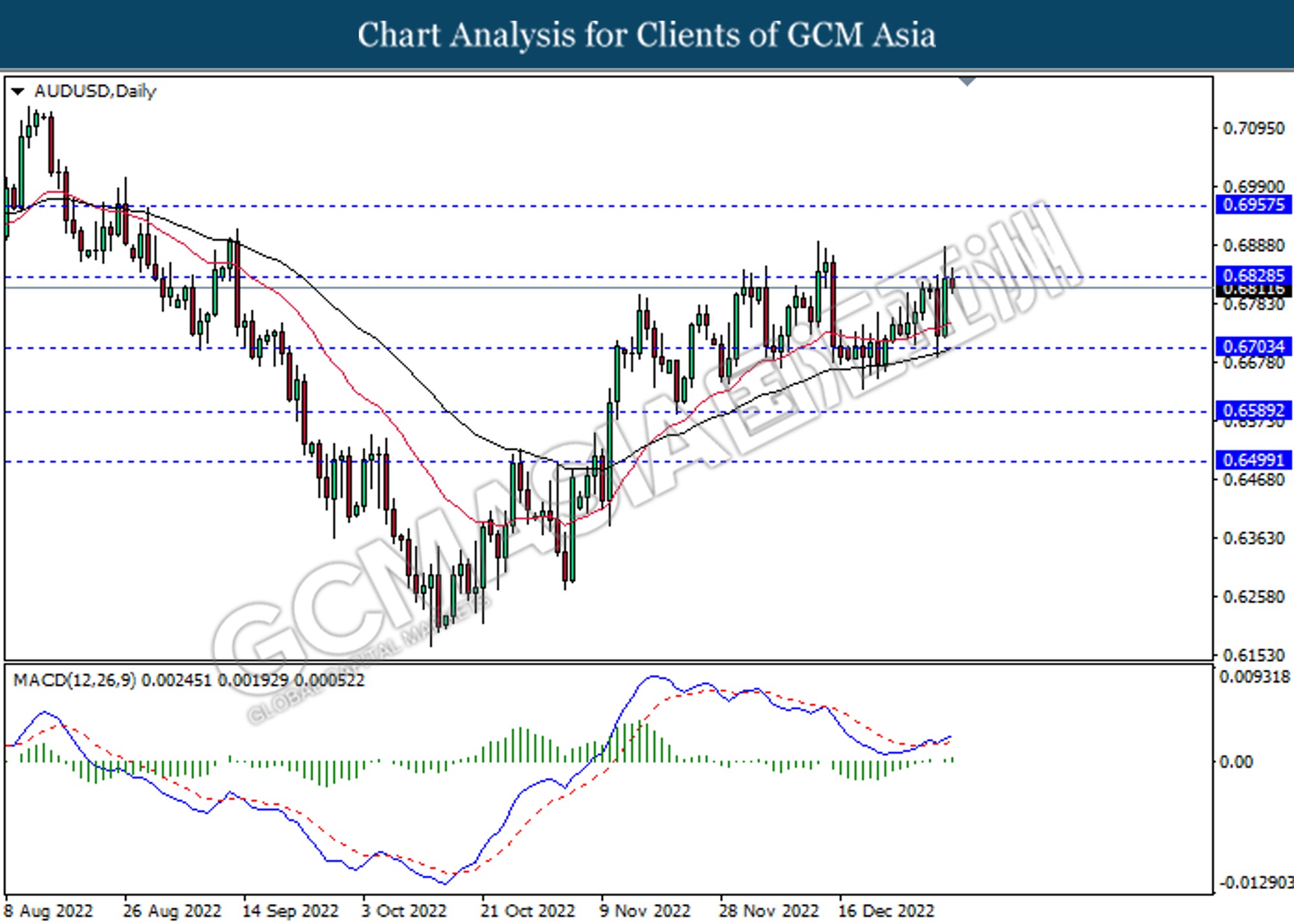

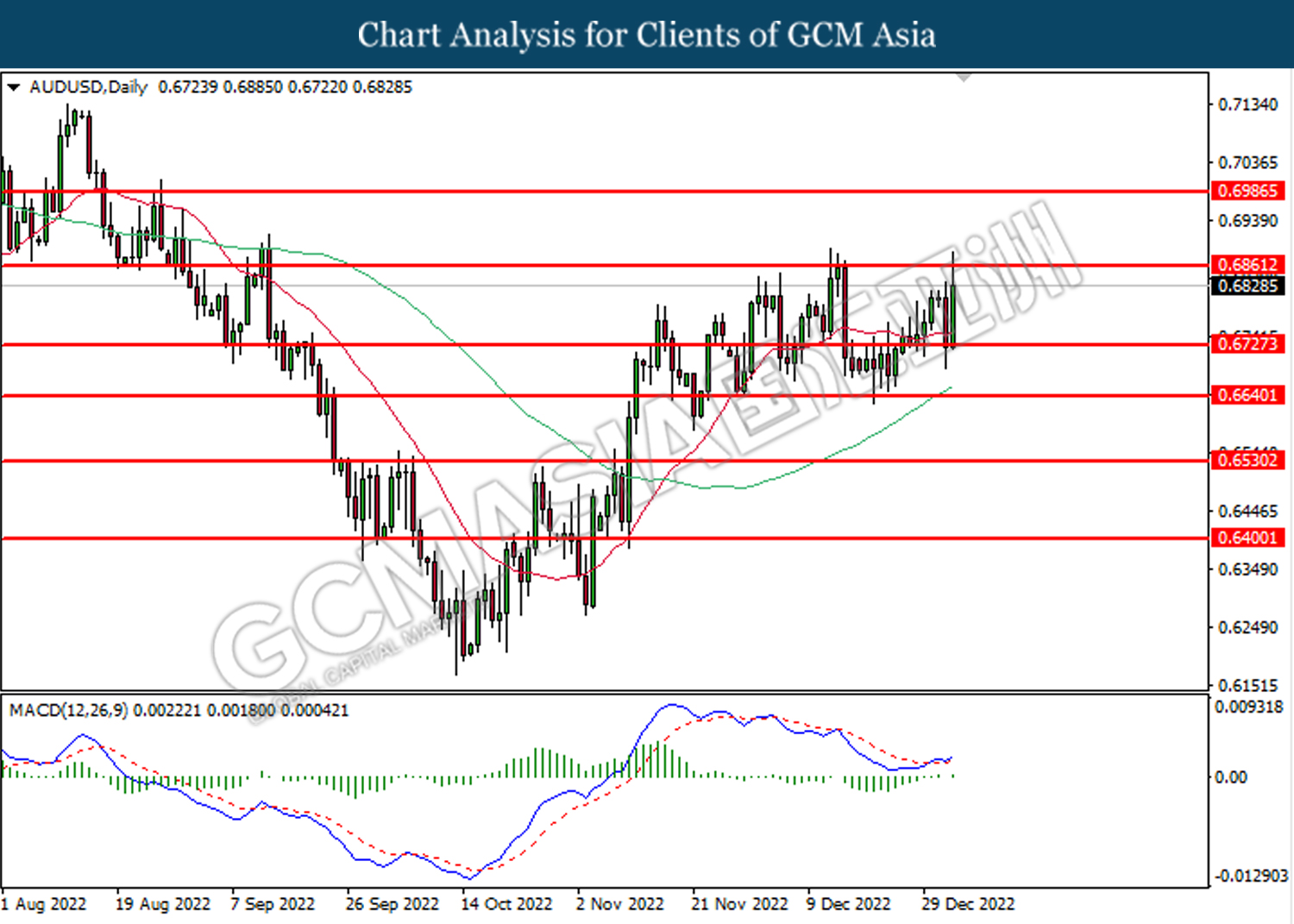

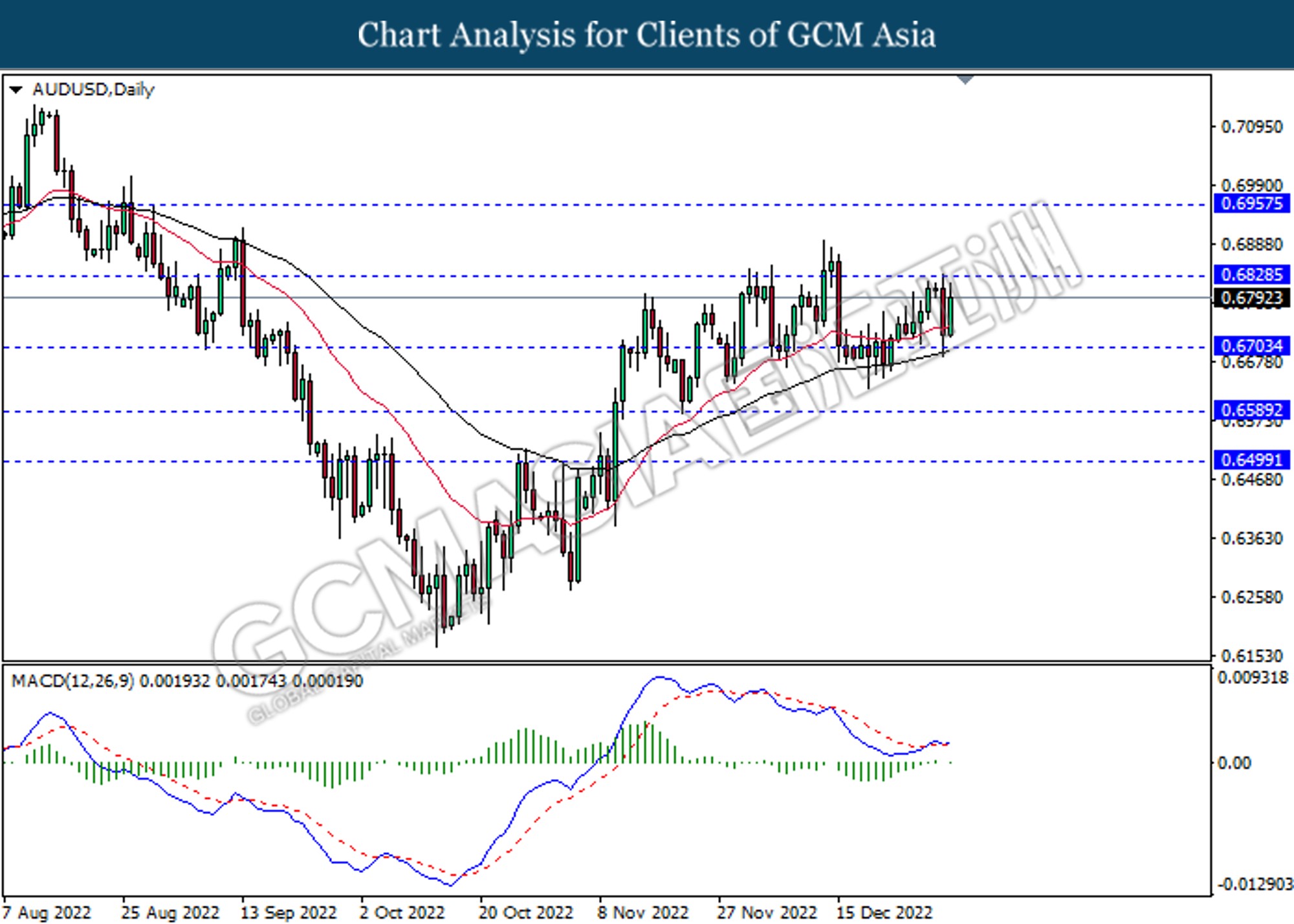

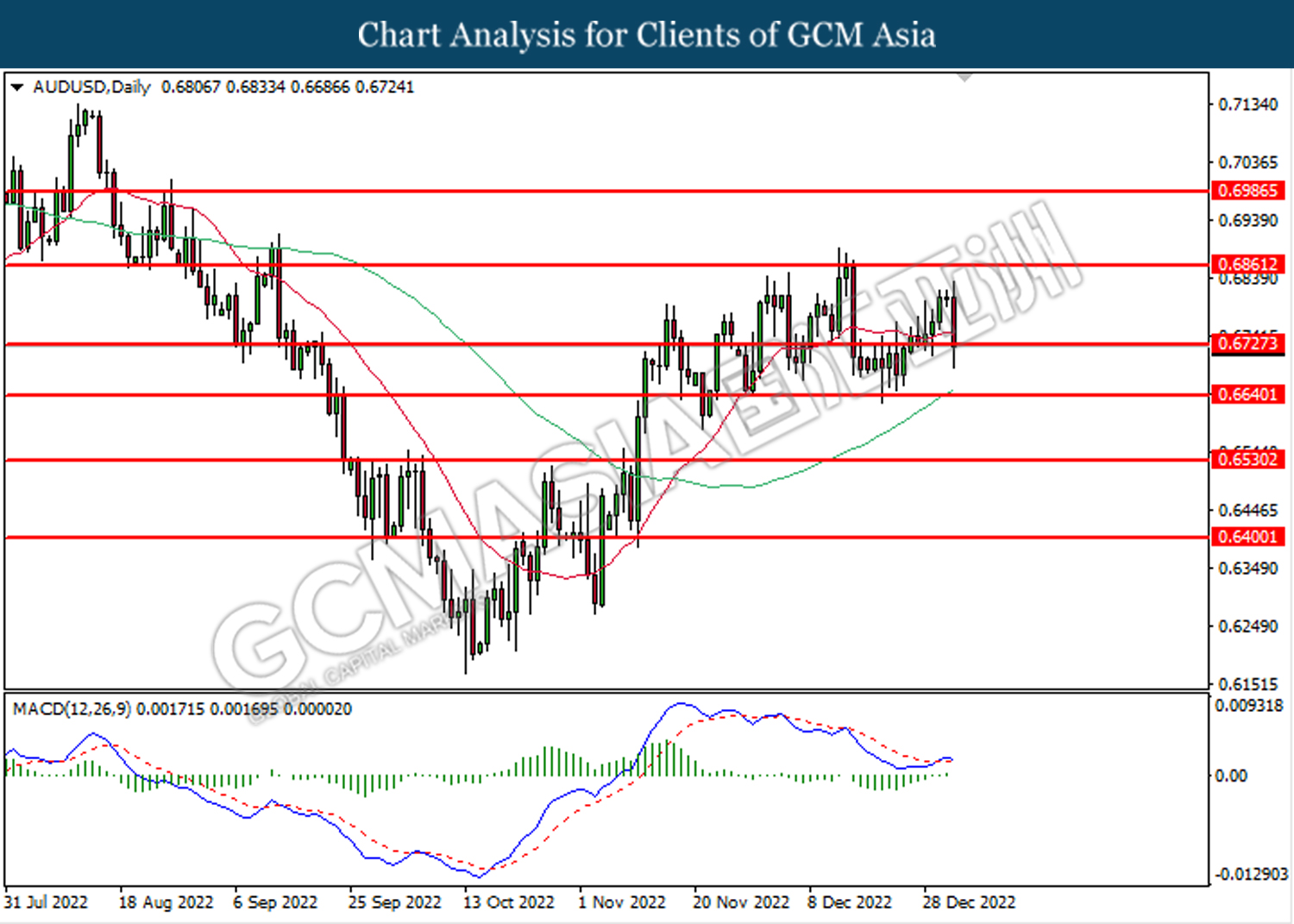

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7050, 0.7140

Support level: 0.6955, 0.6830

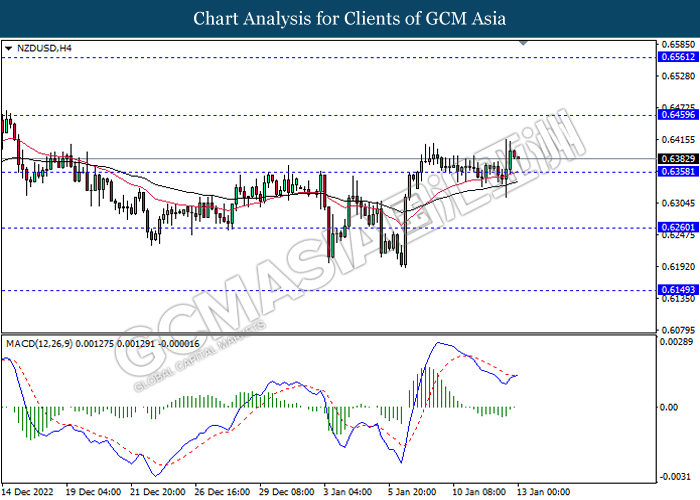

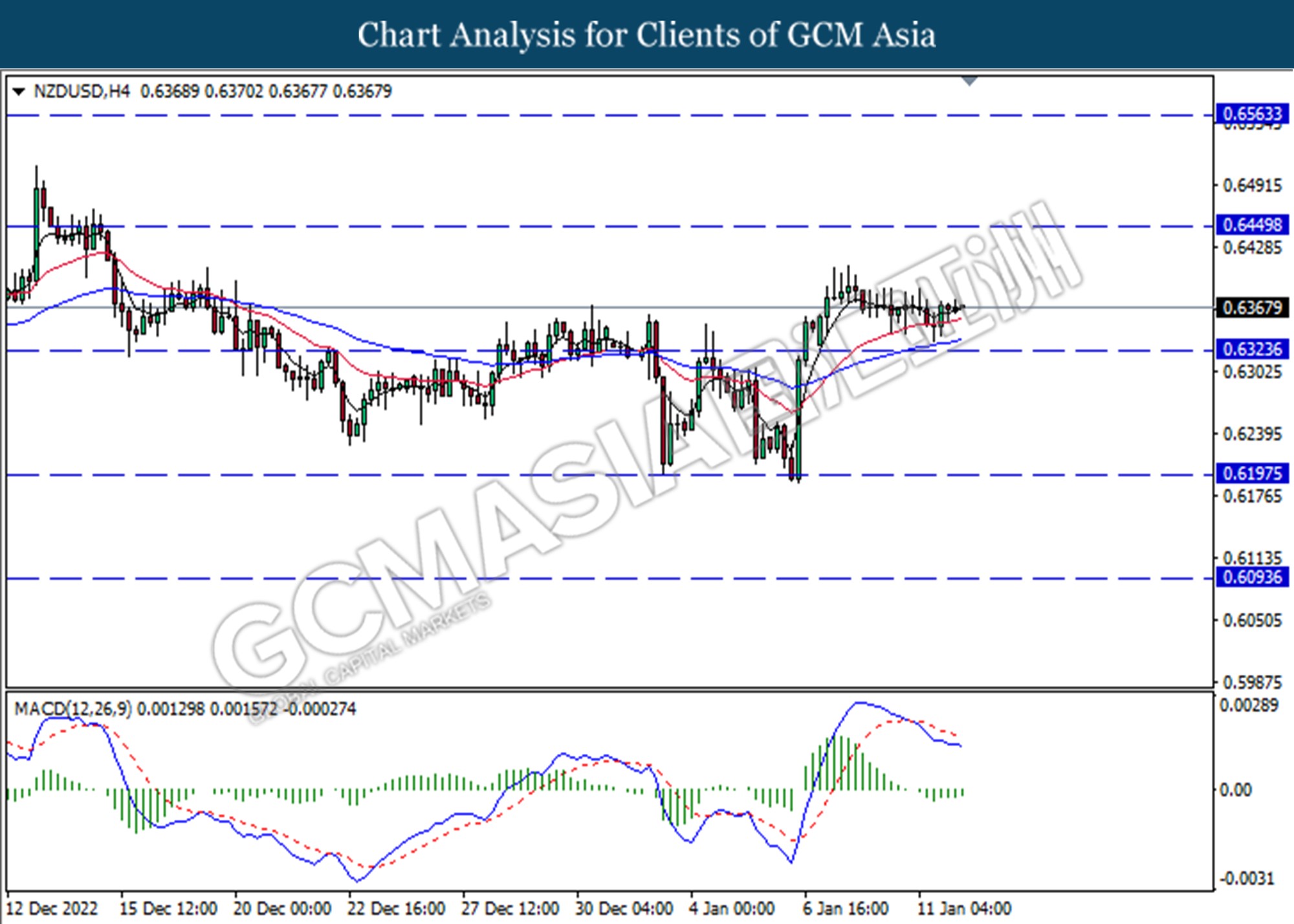

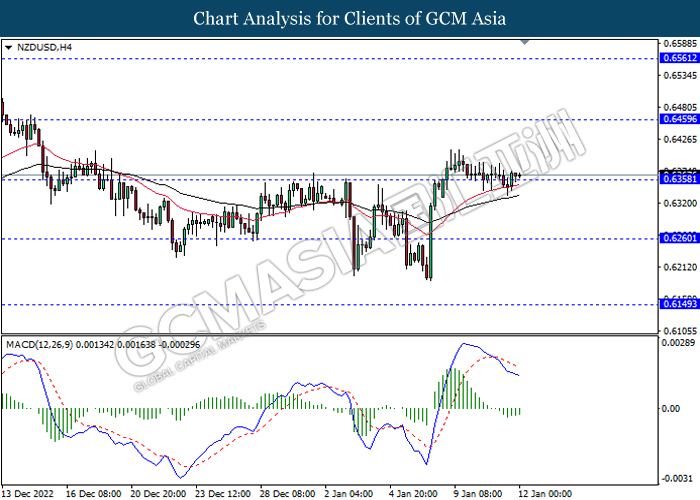

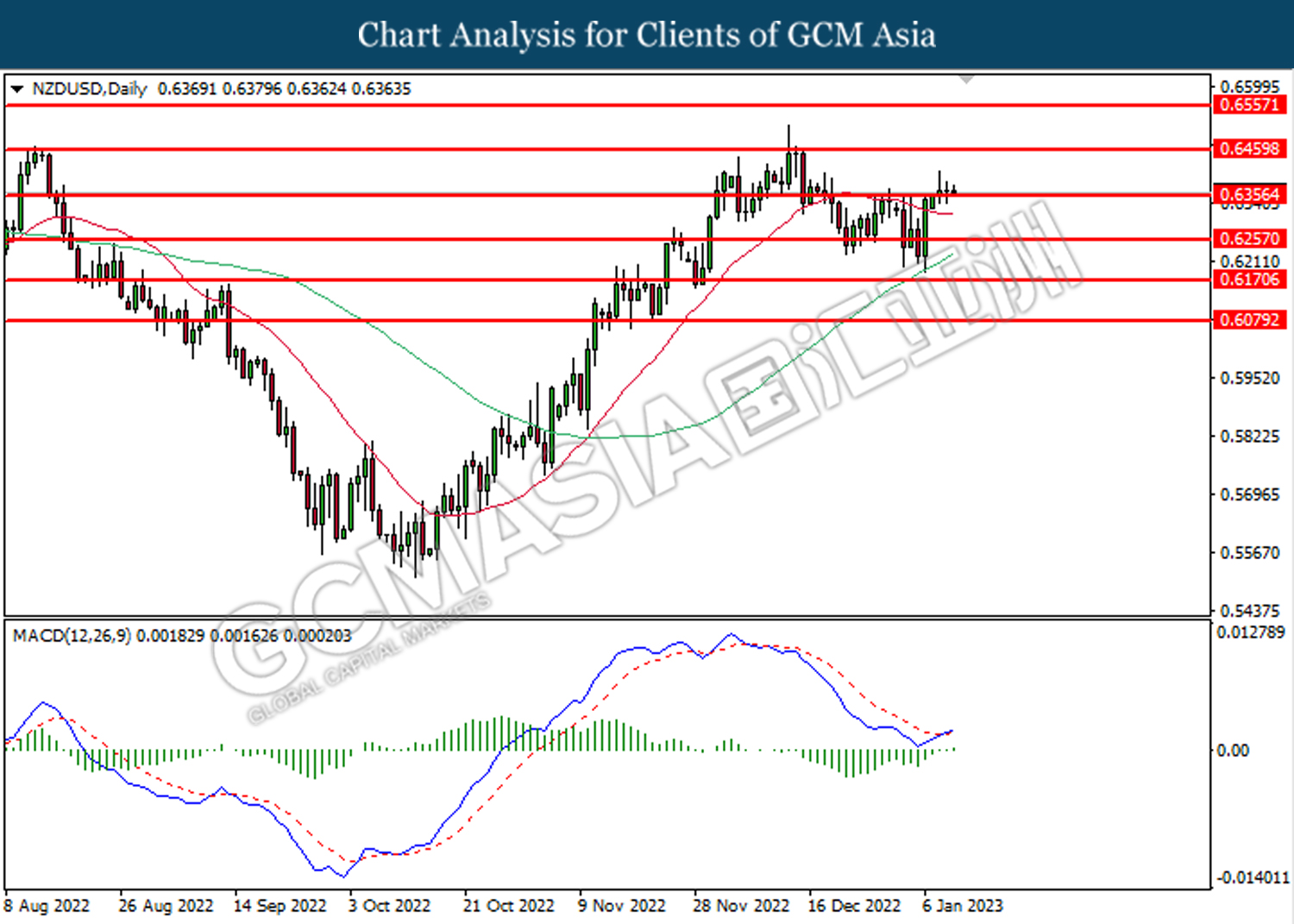

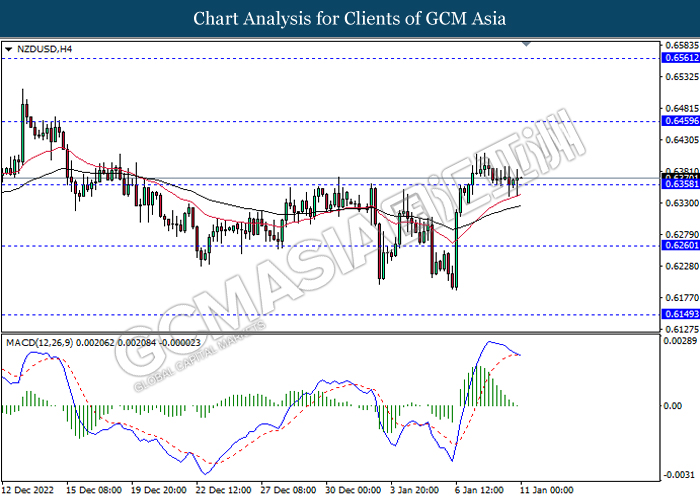

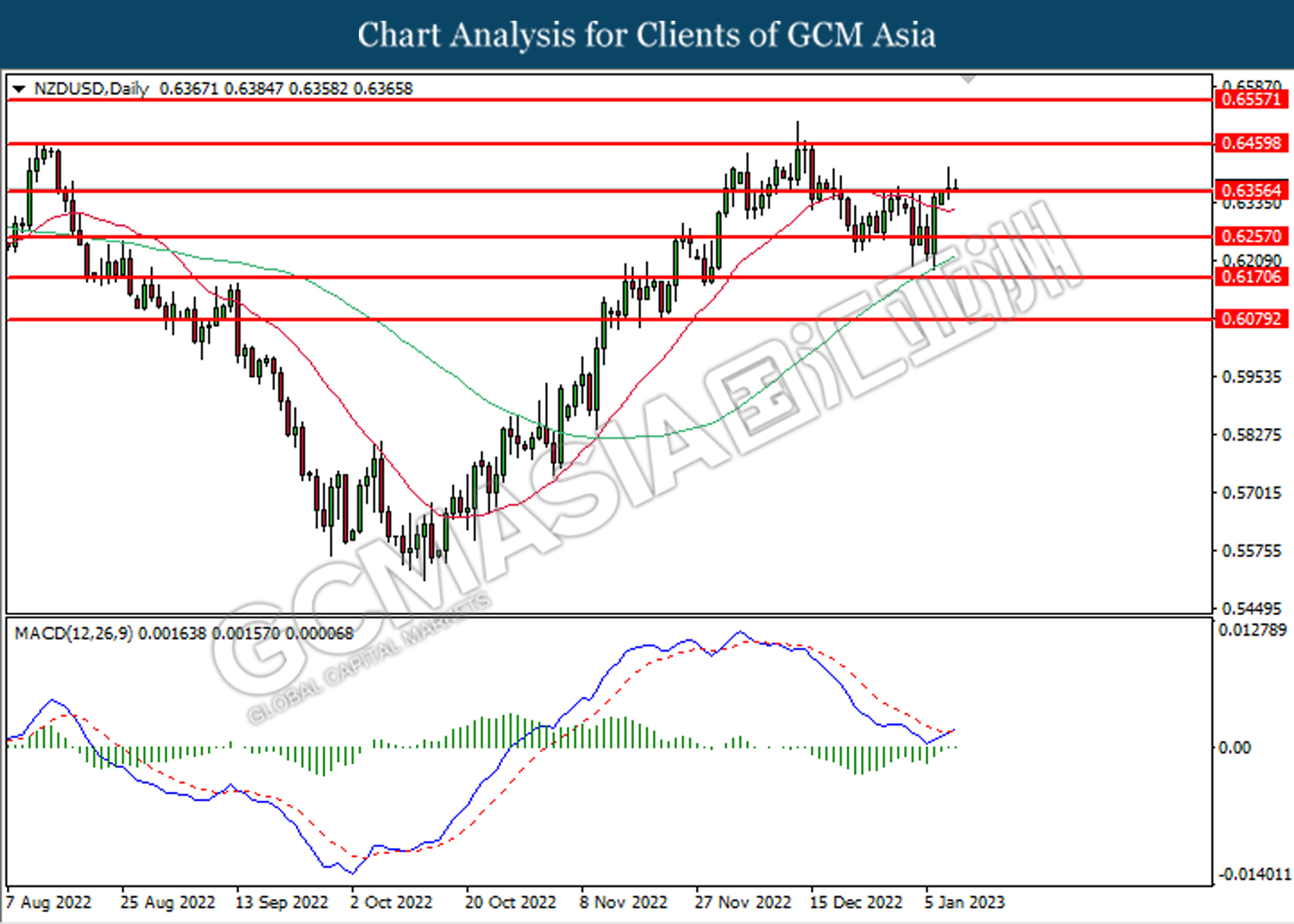

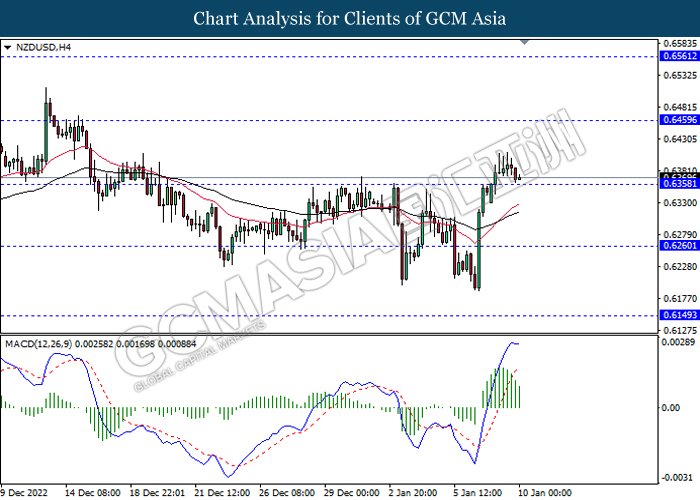

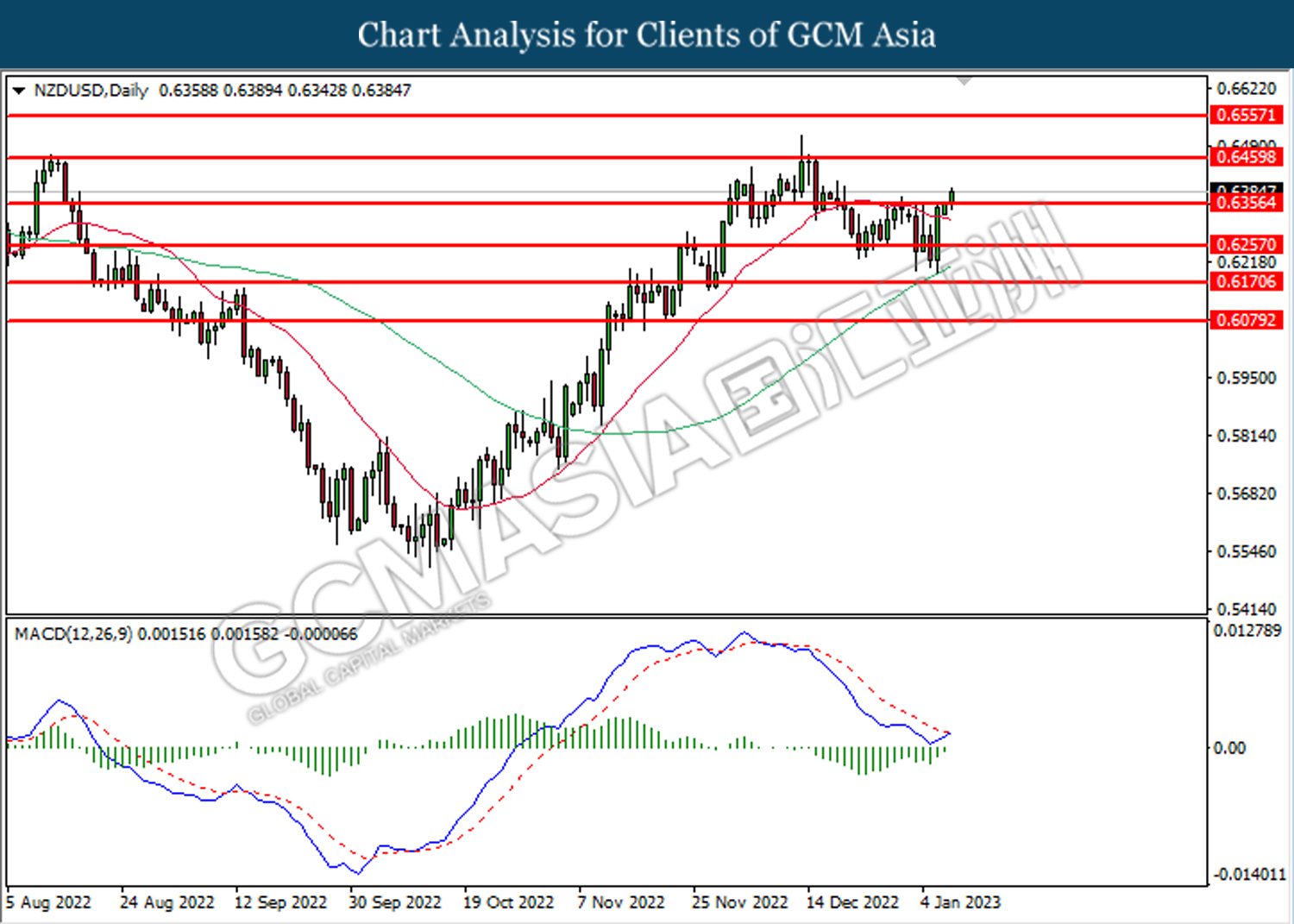

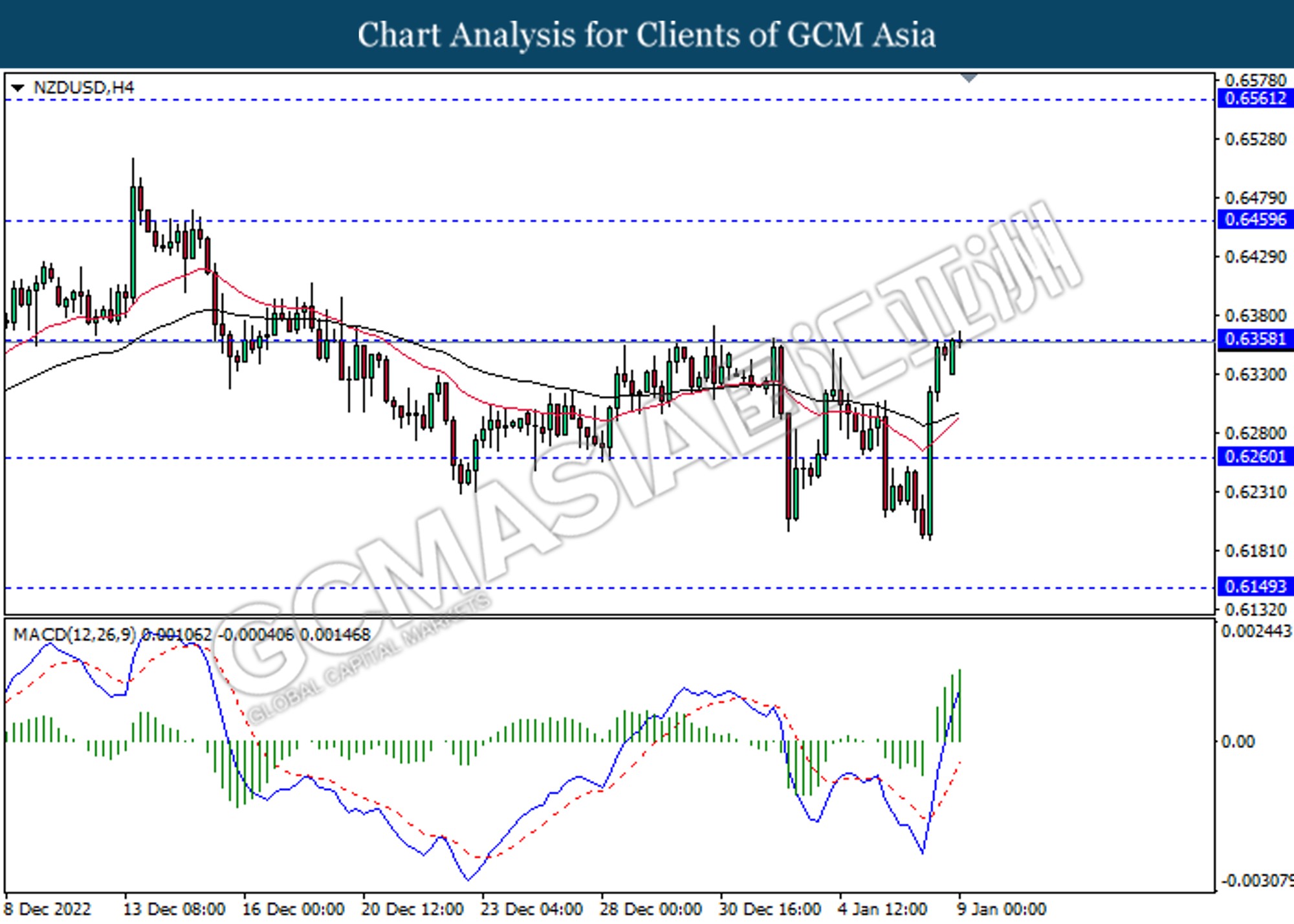

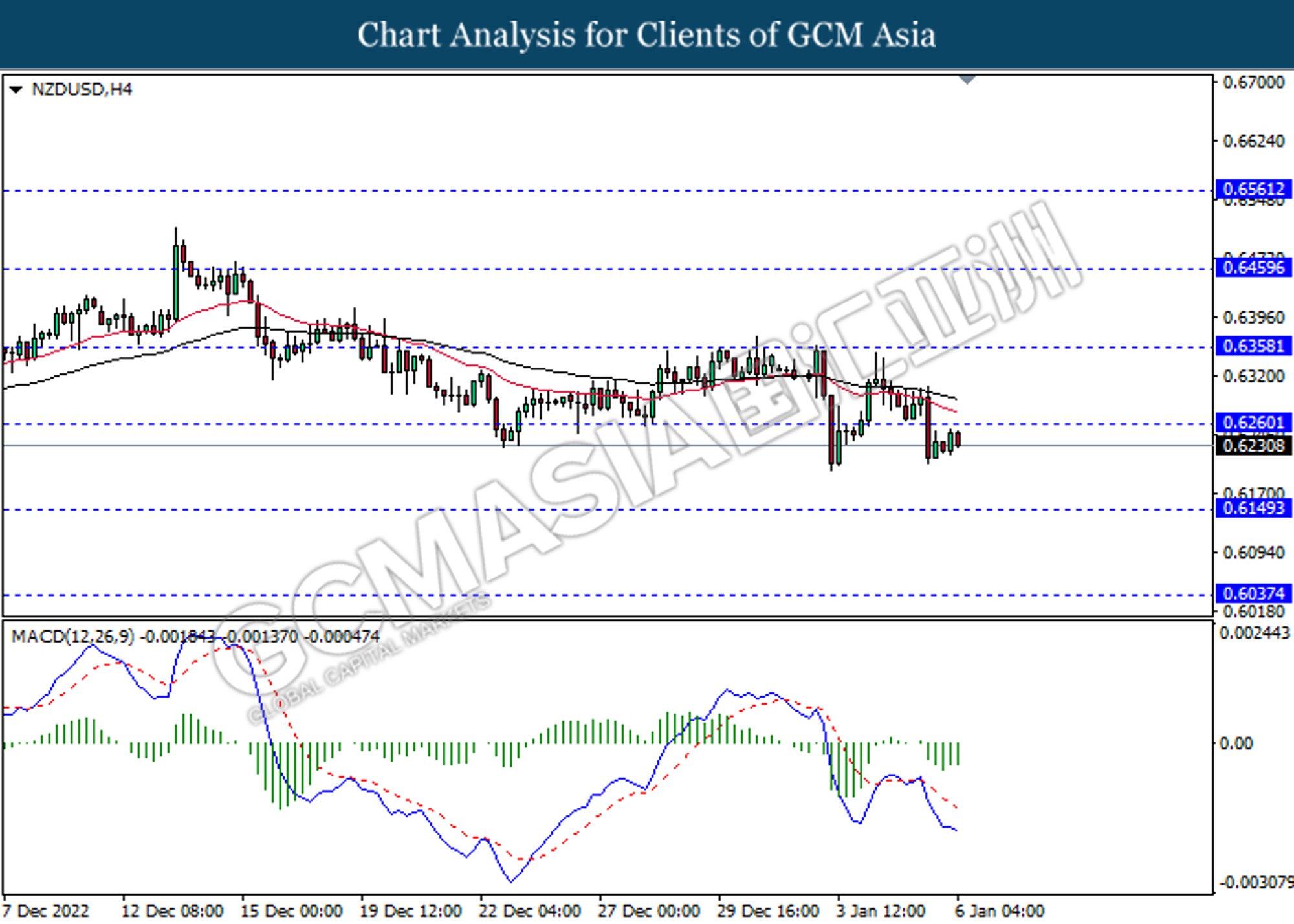

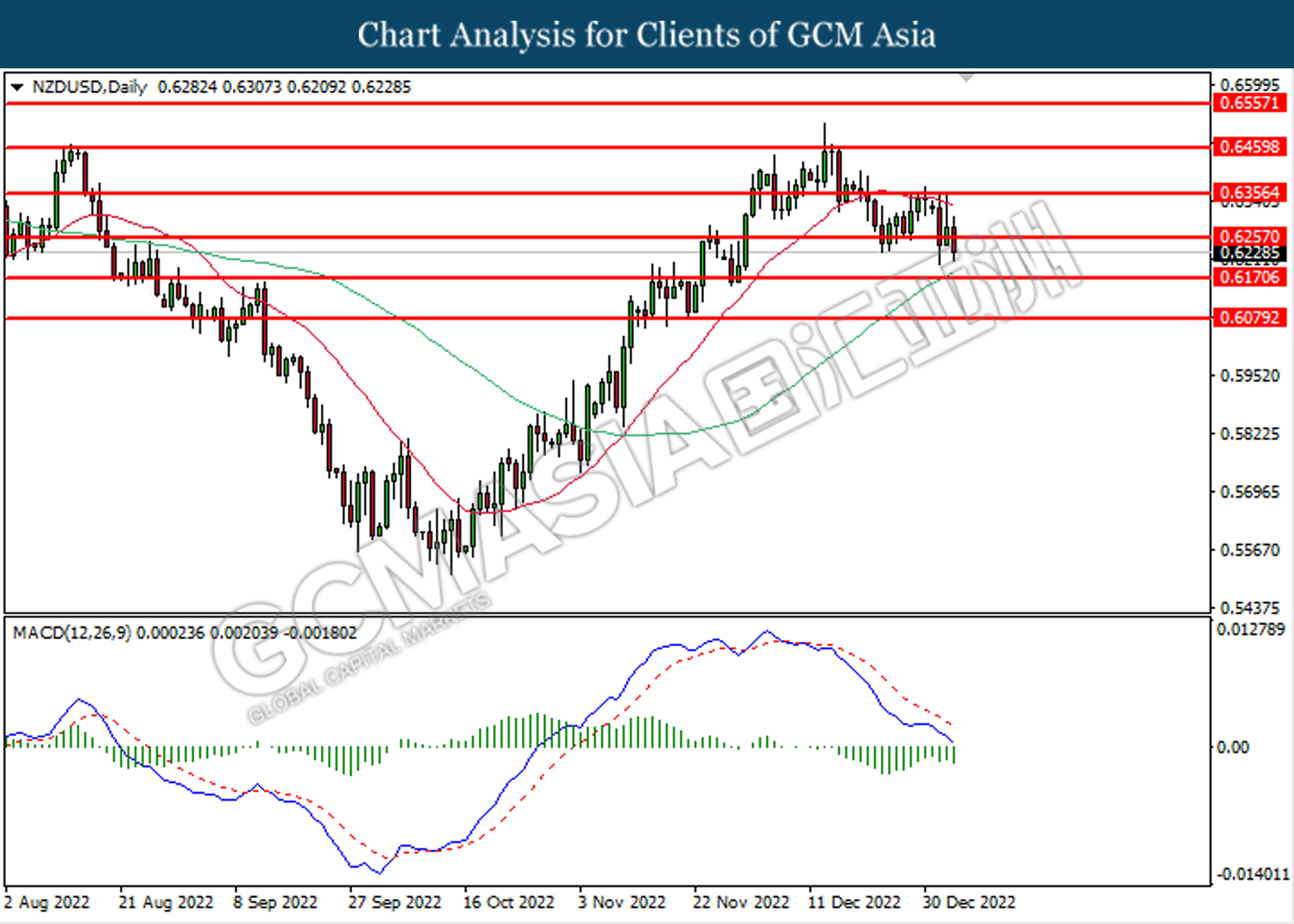

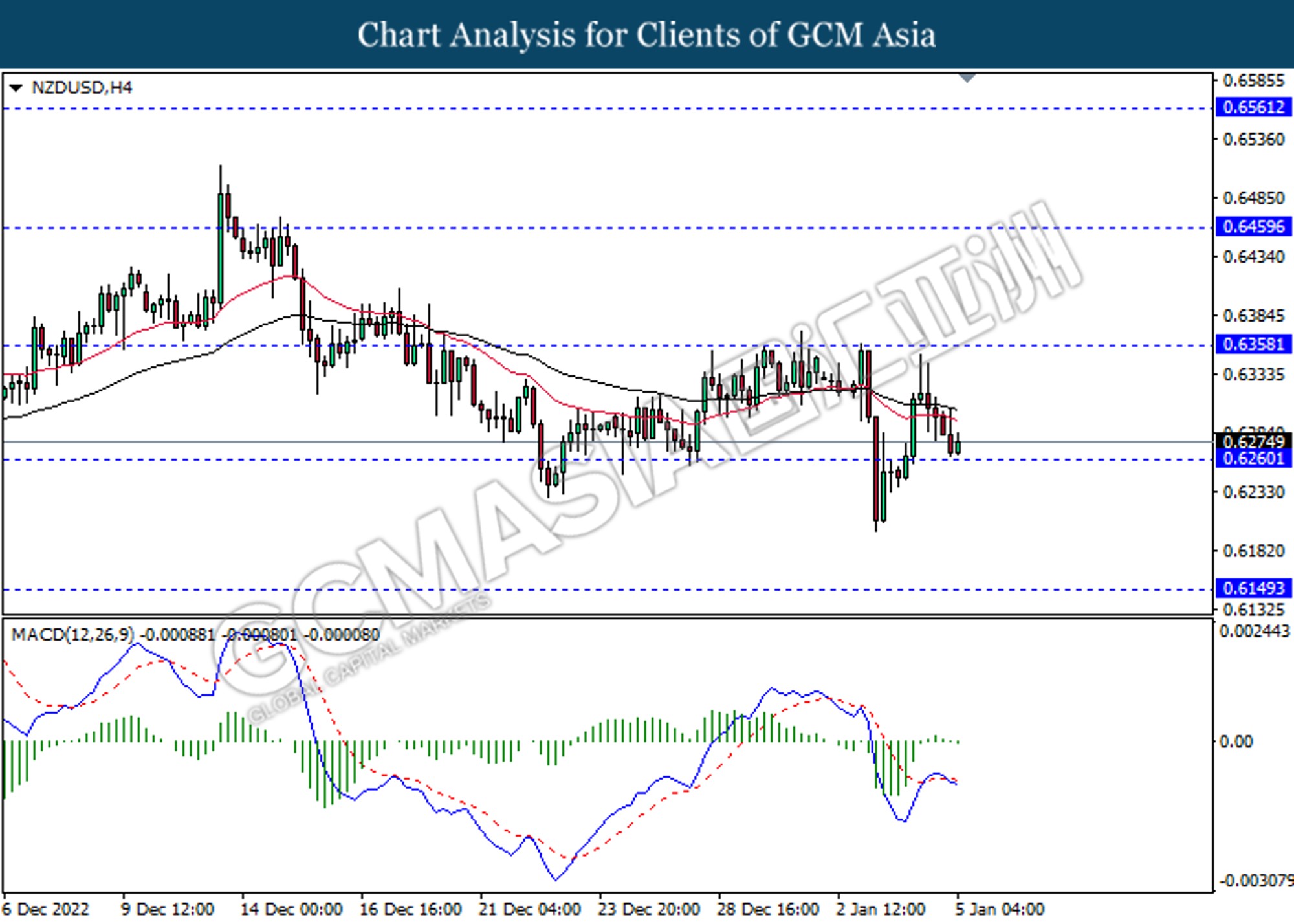

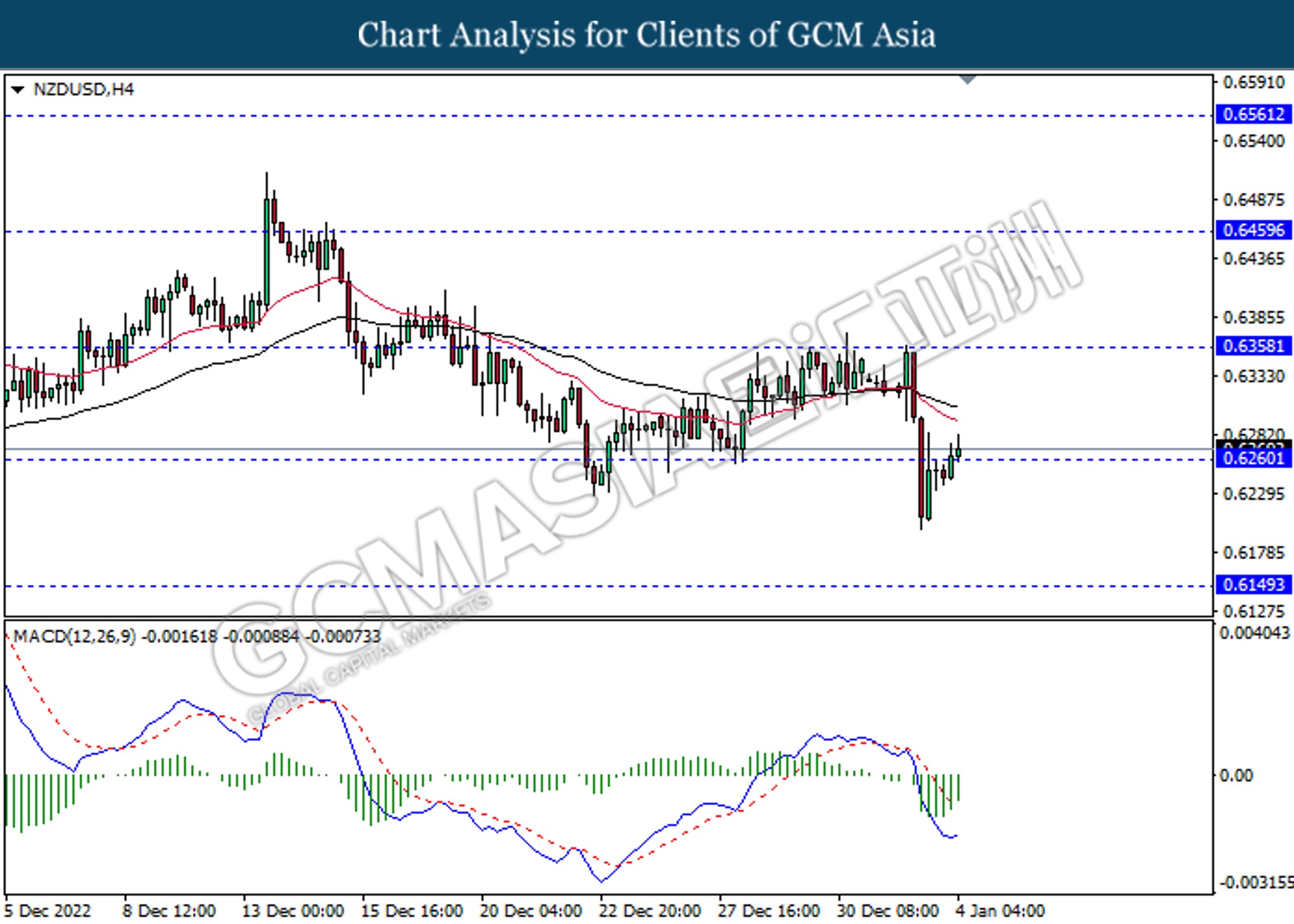

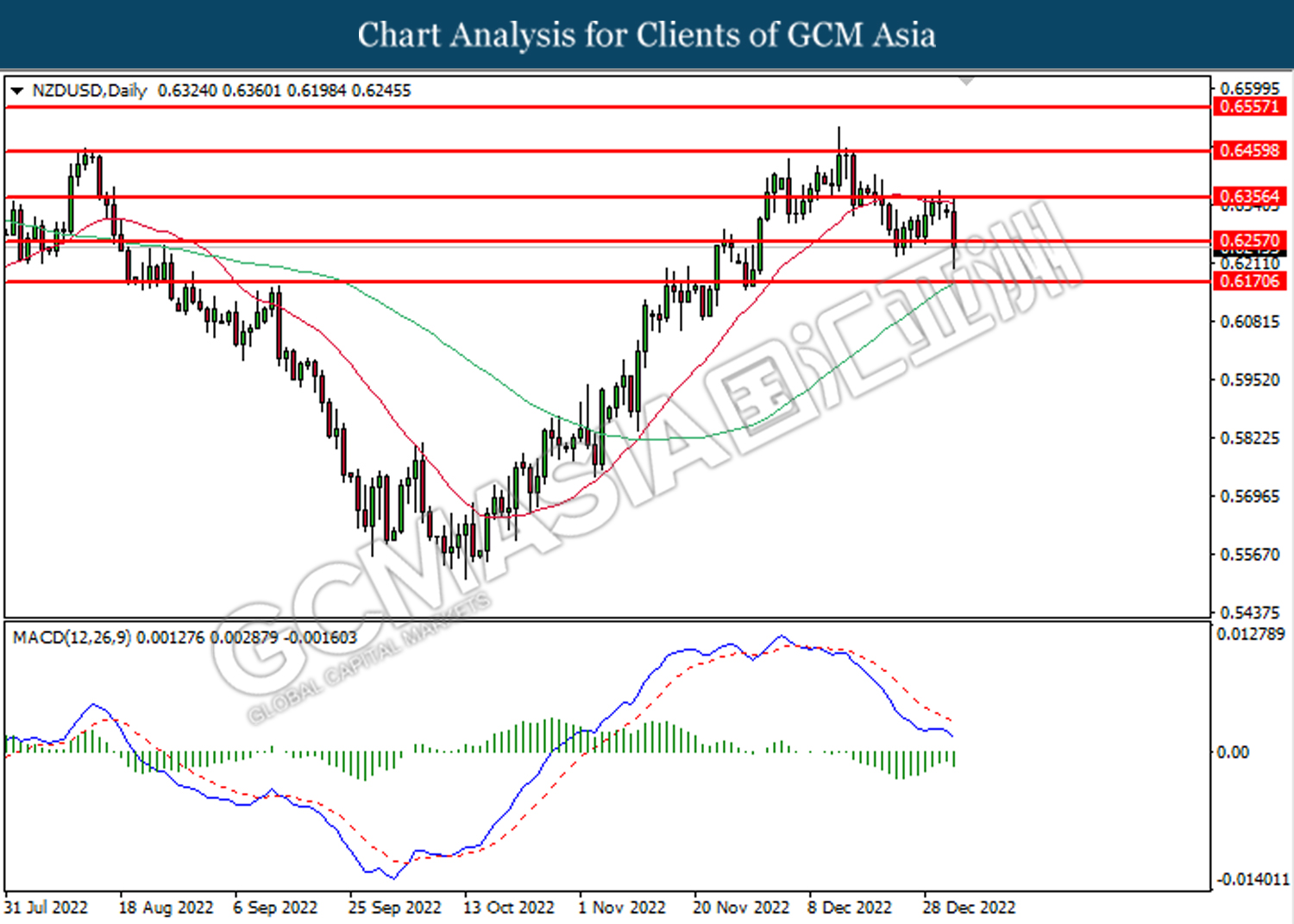

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

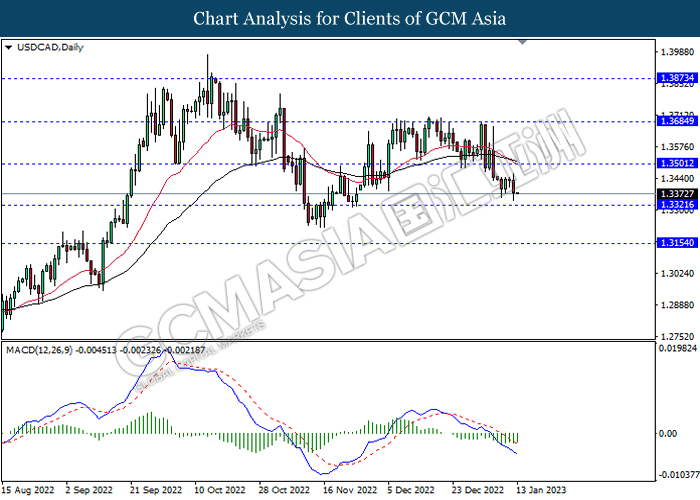

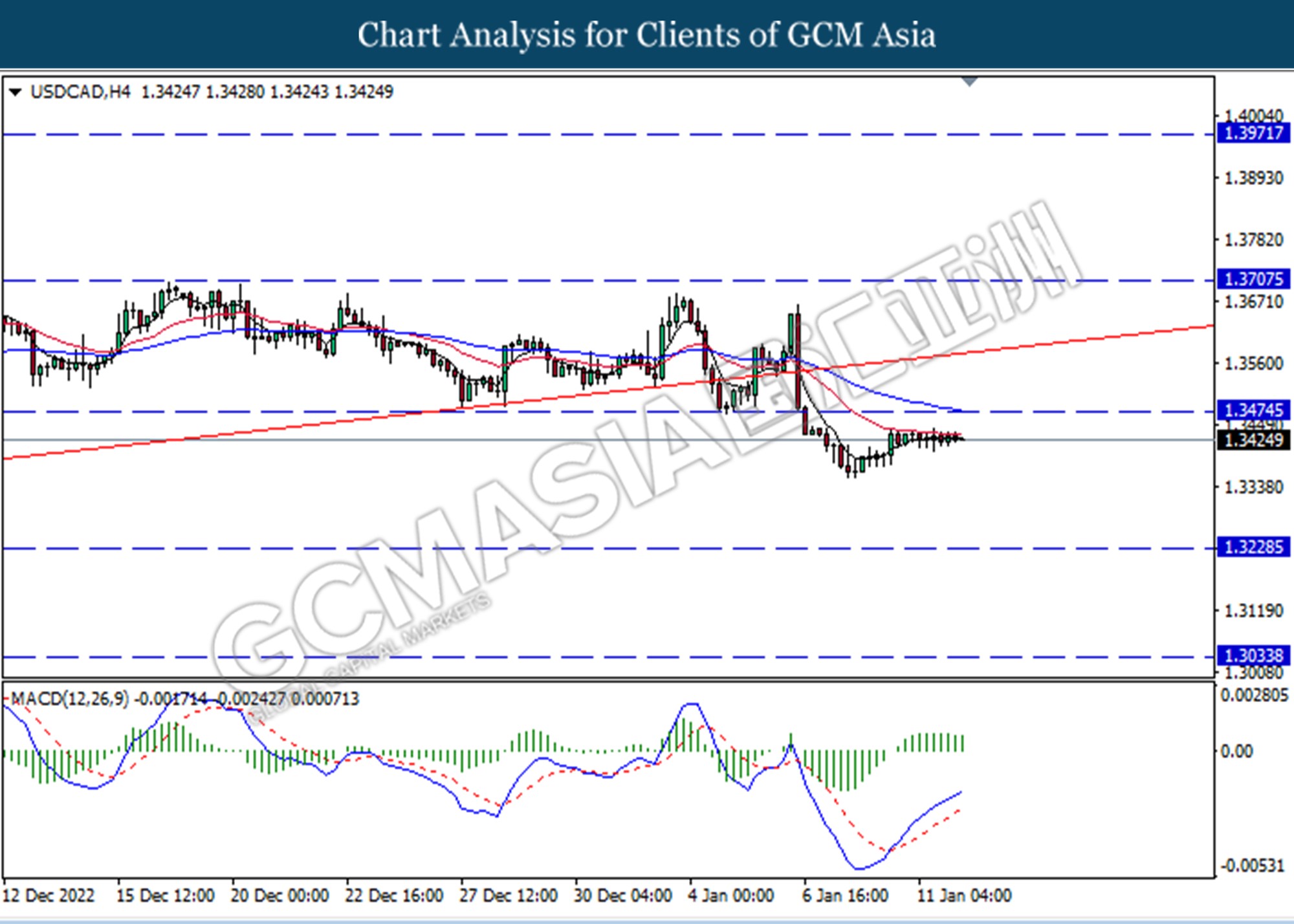

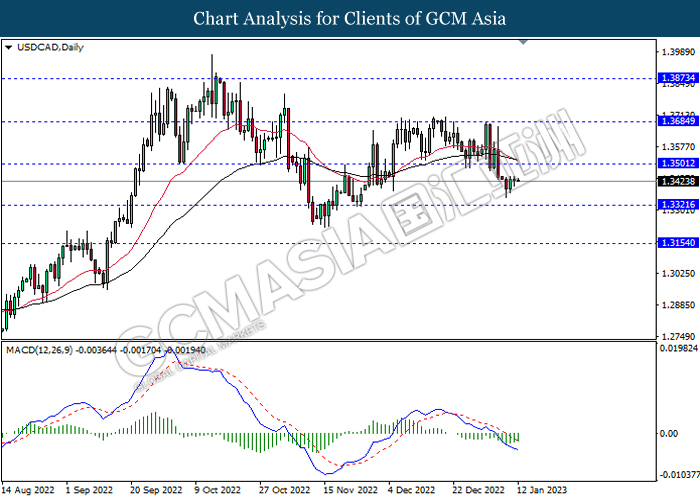

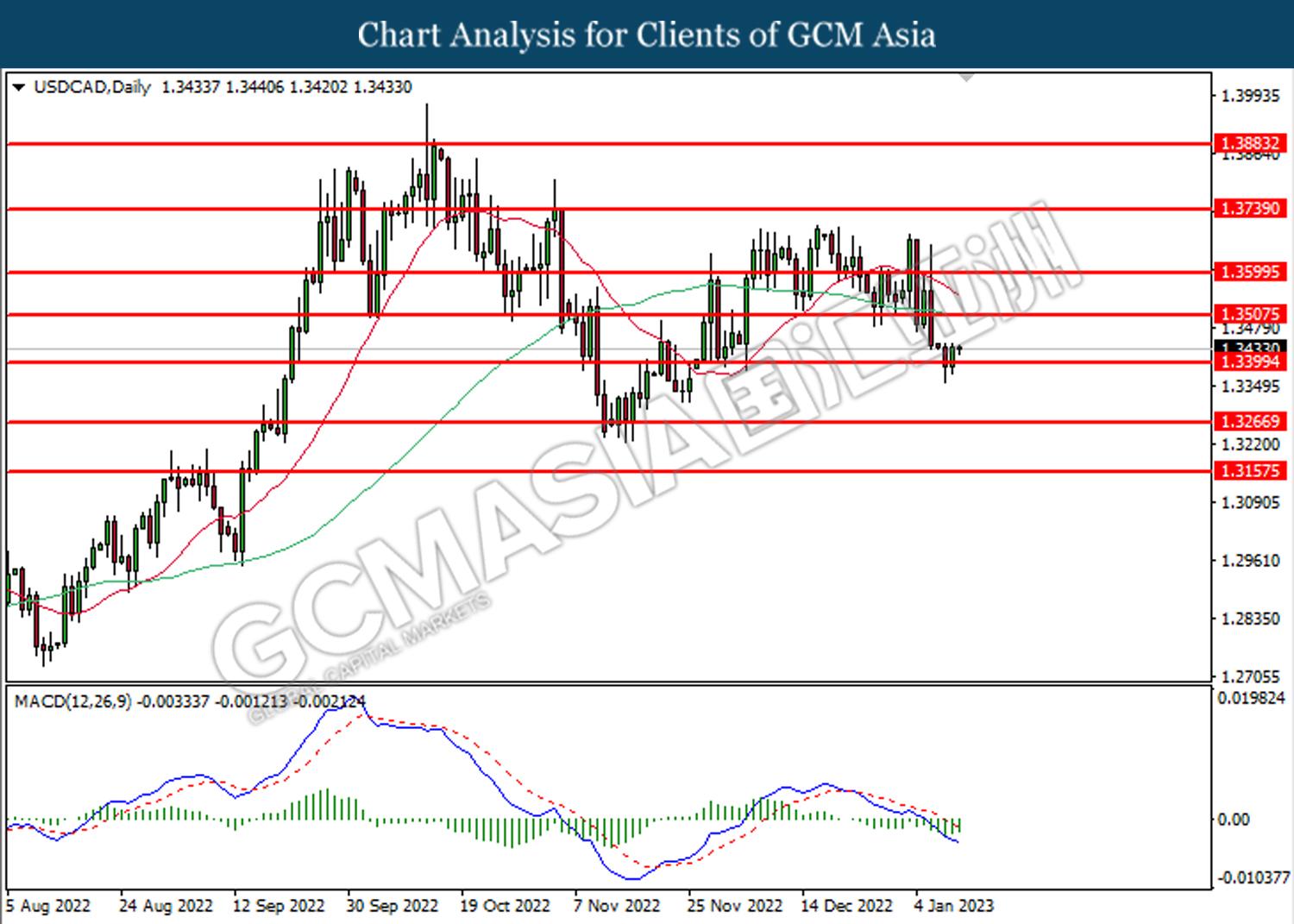

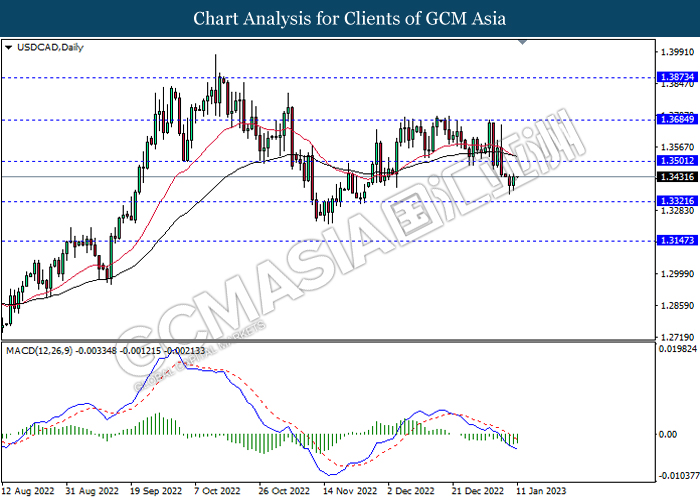

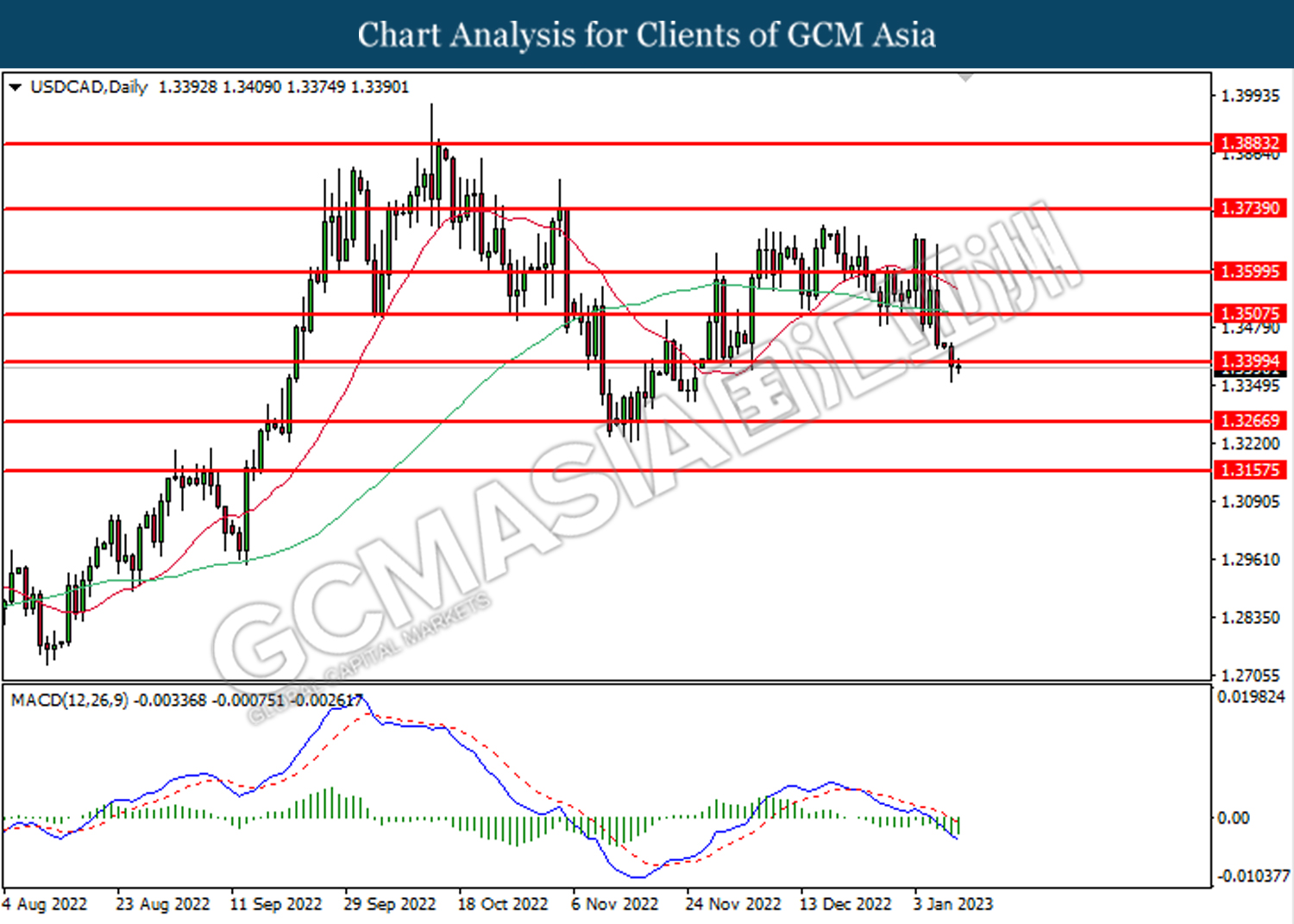

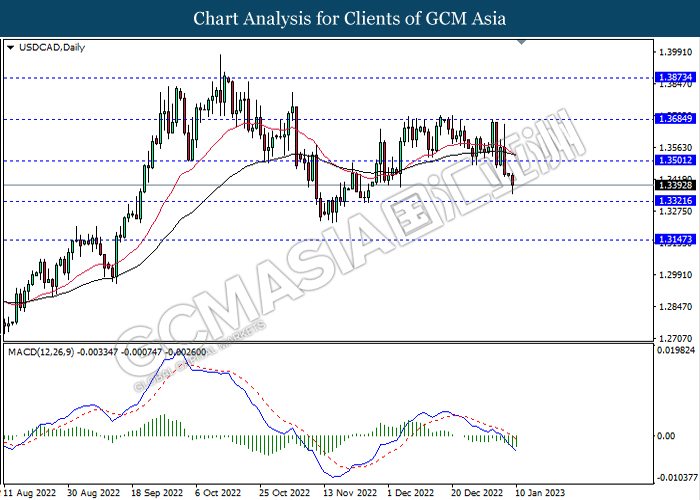

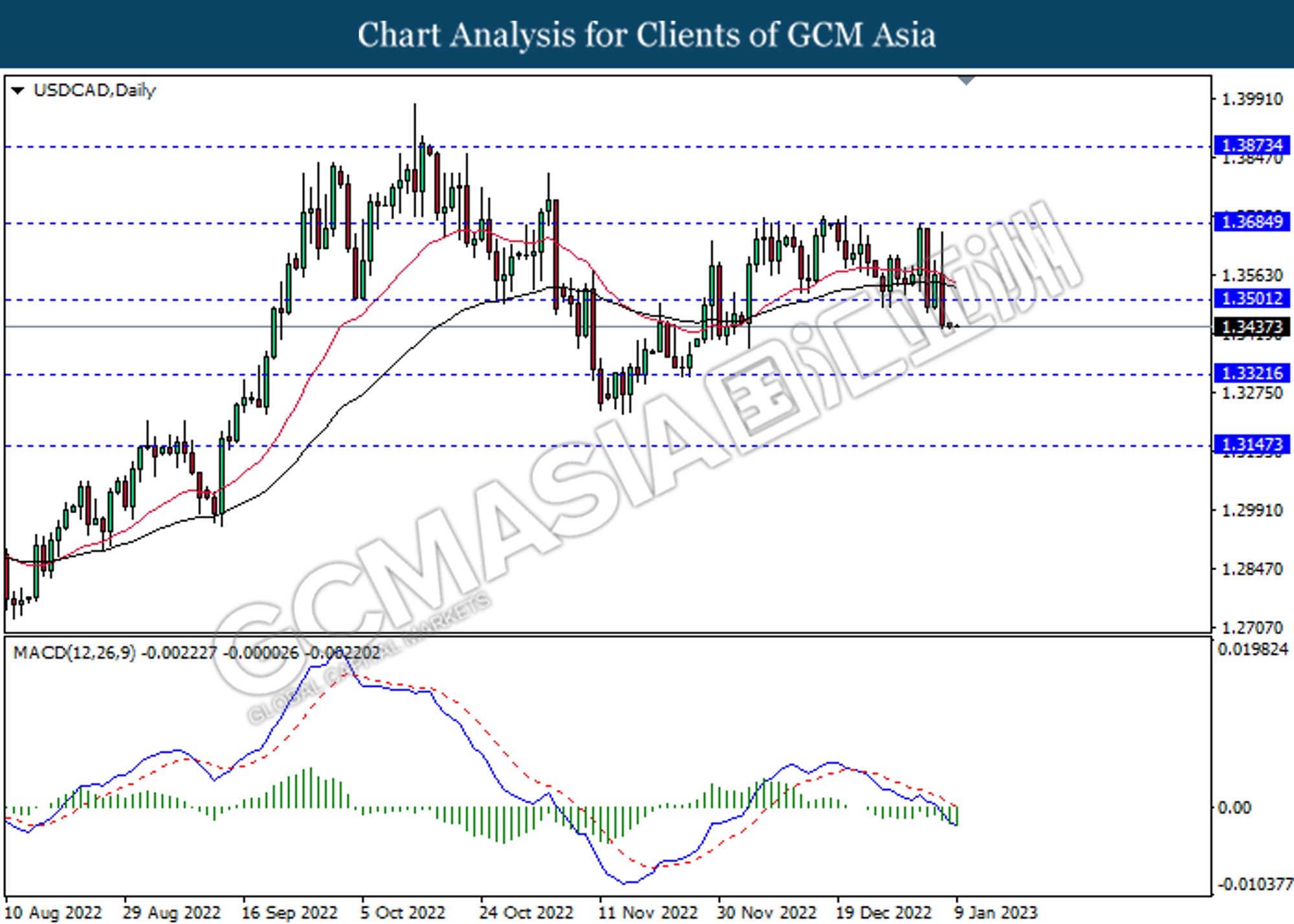

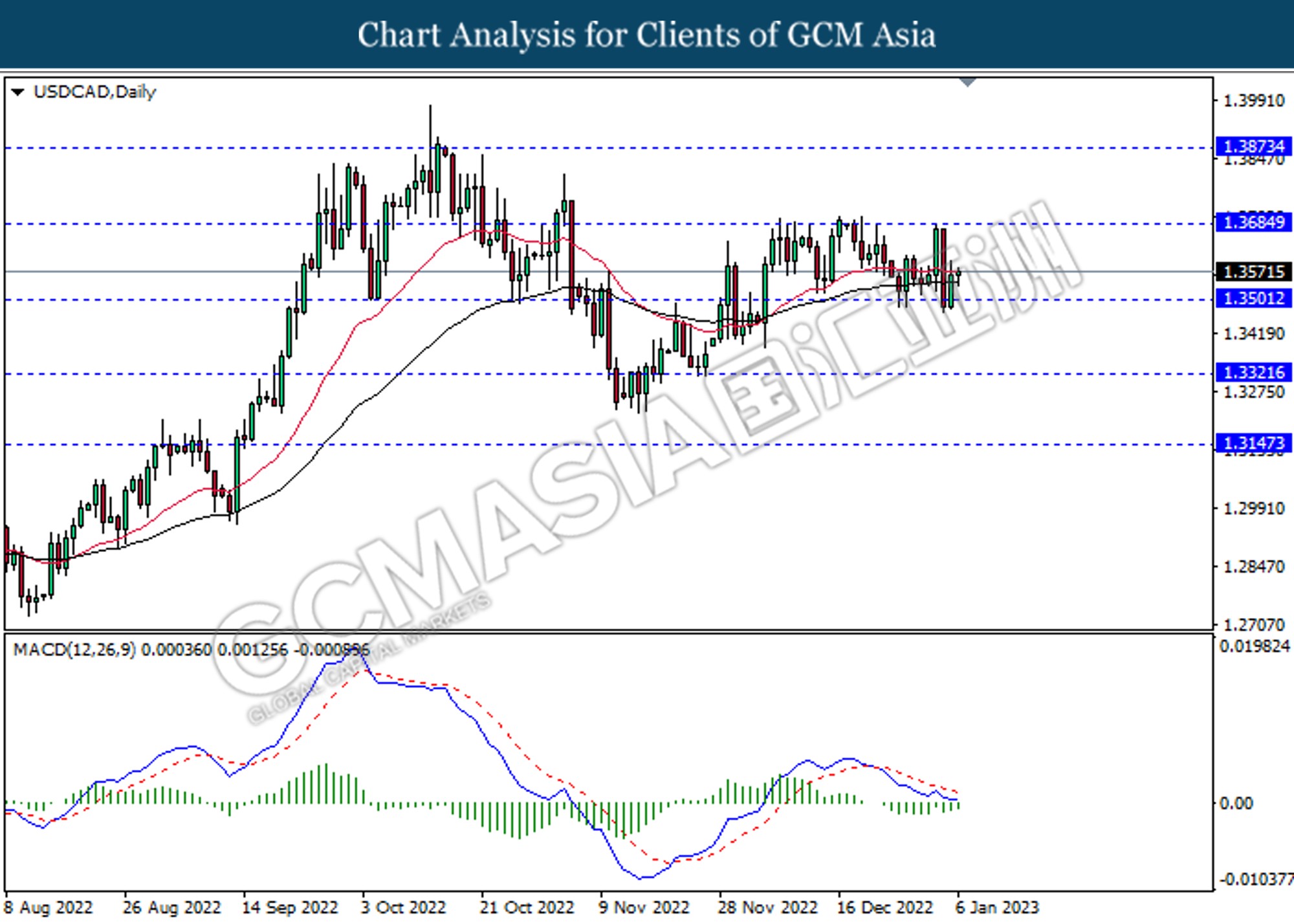

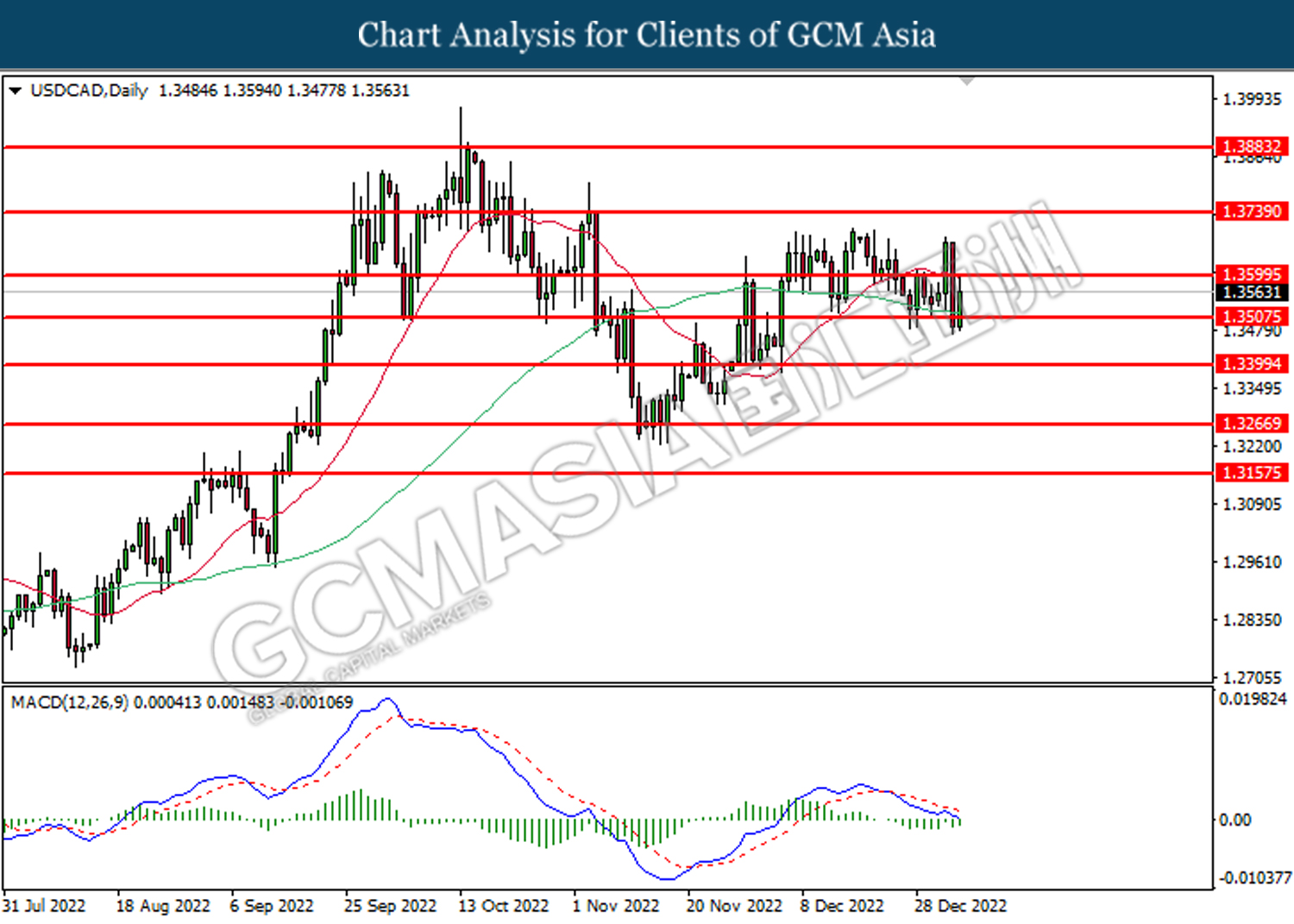

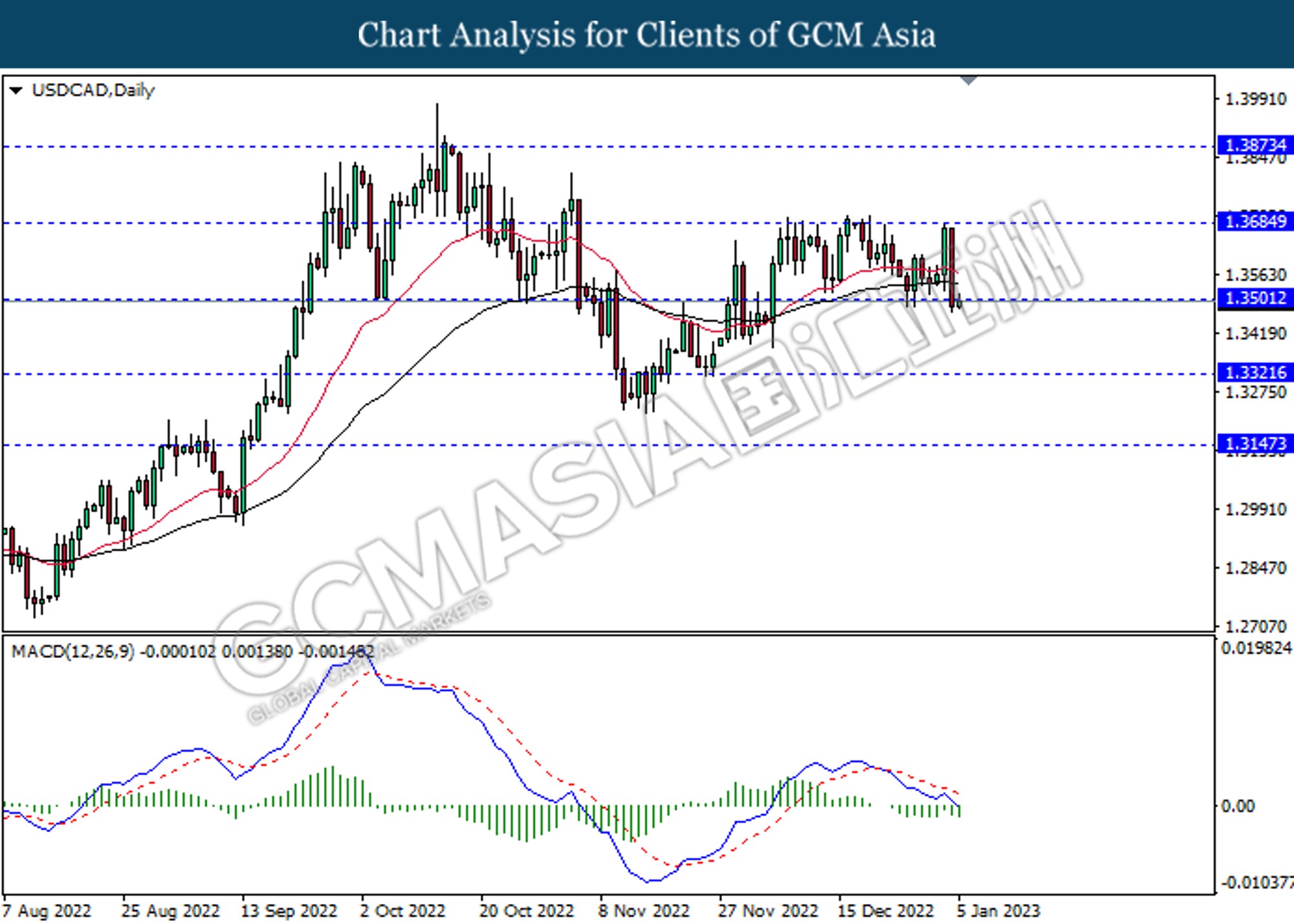

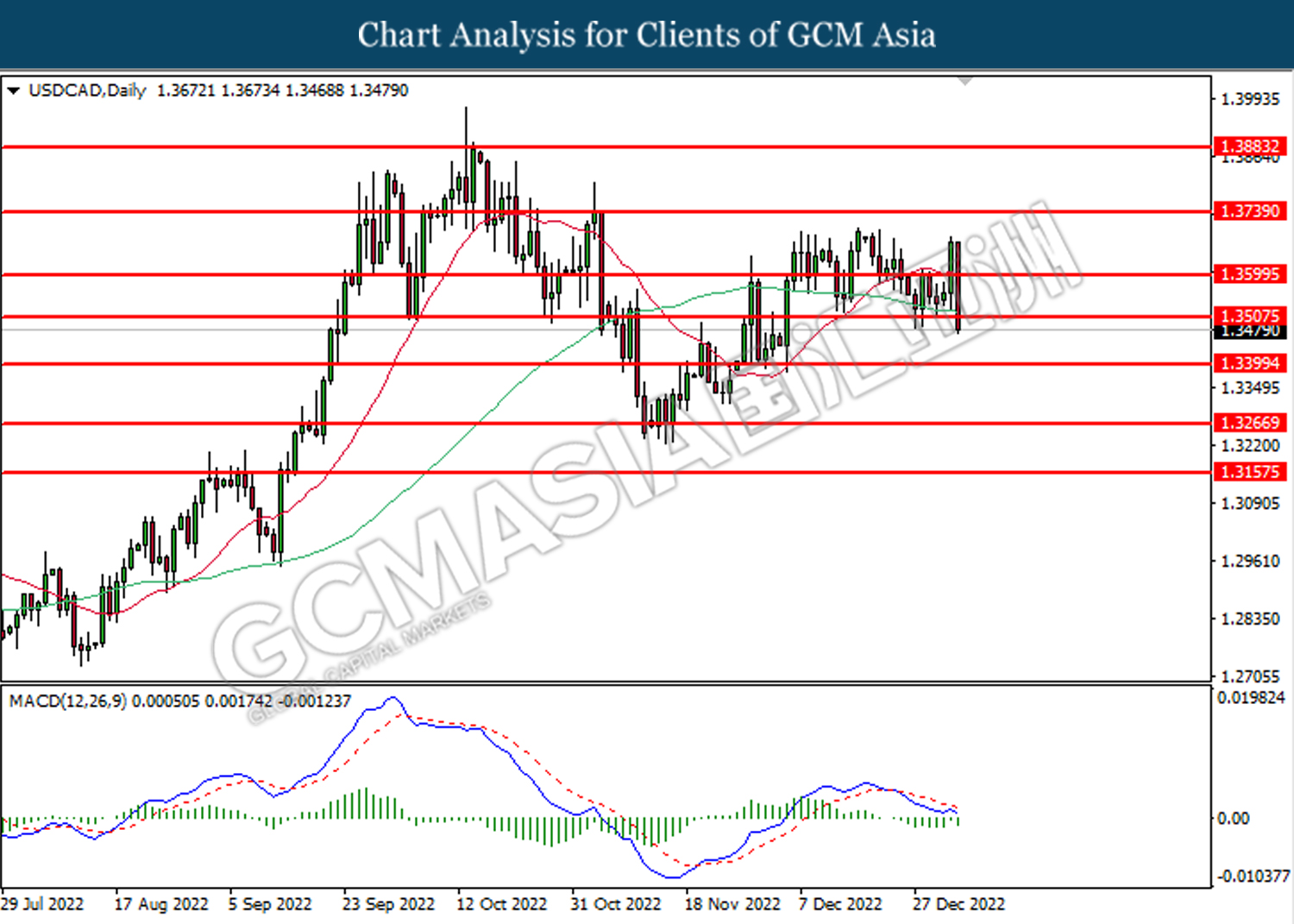

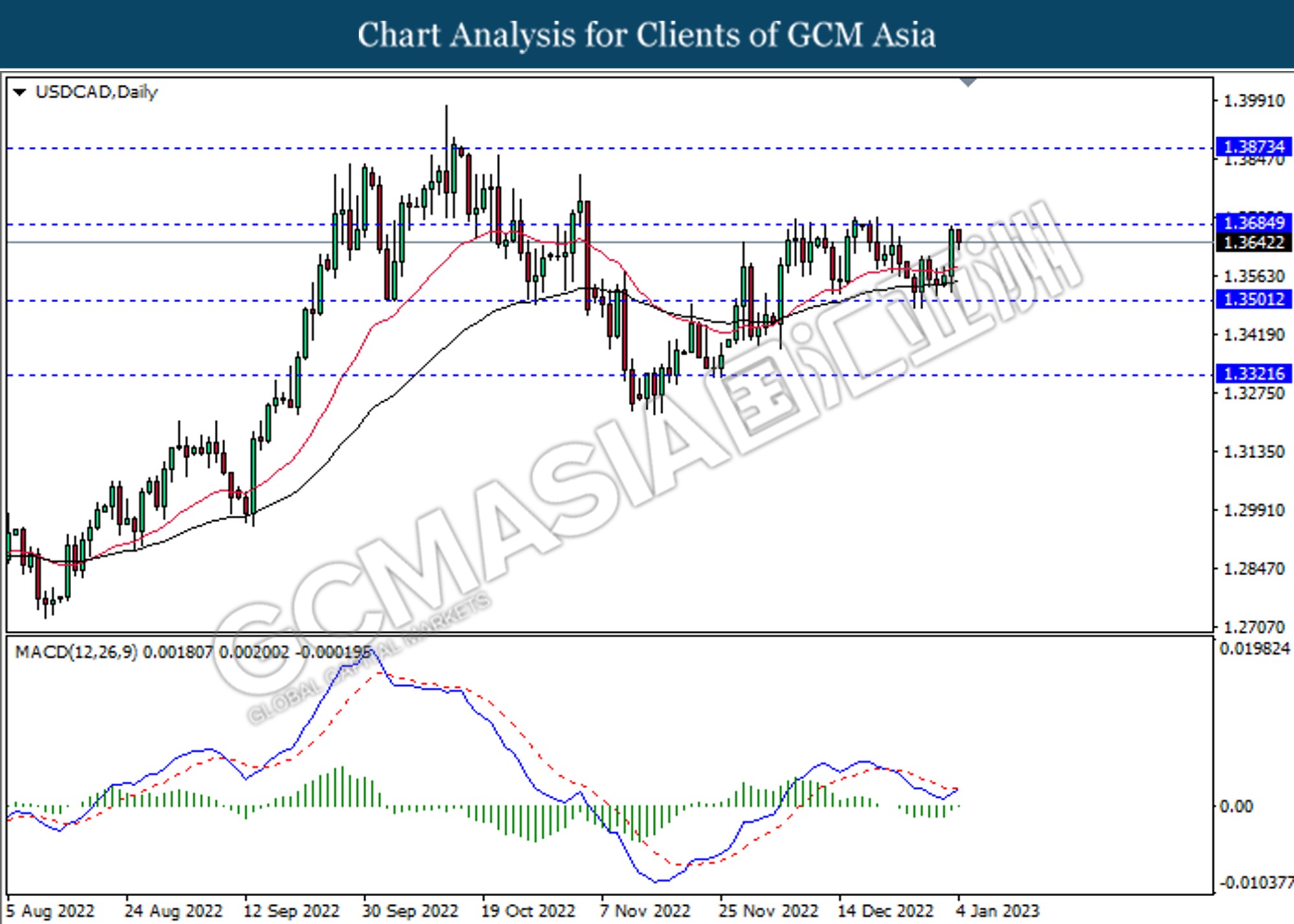

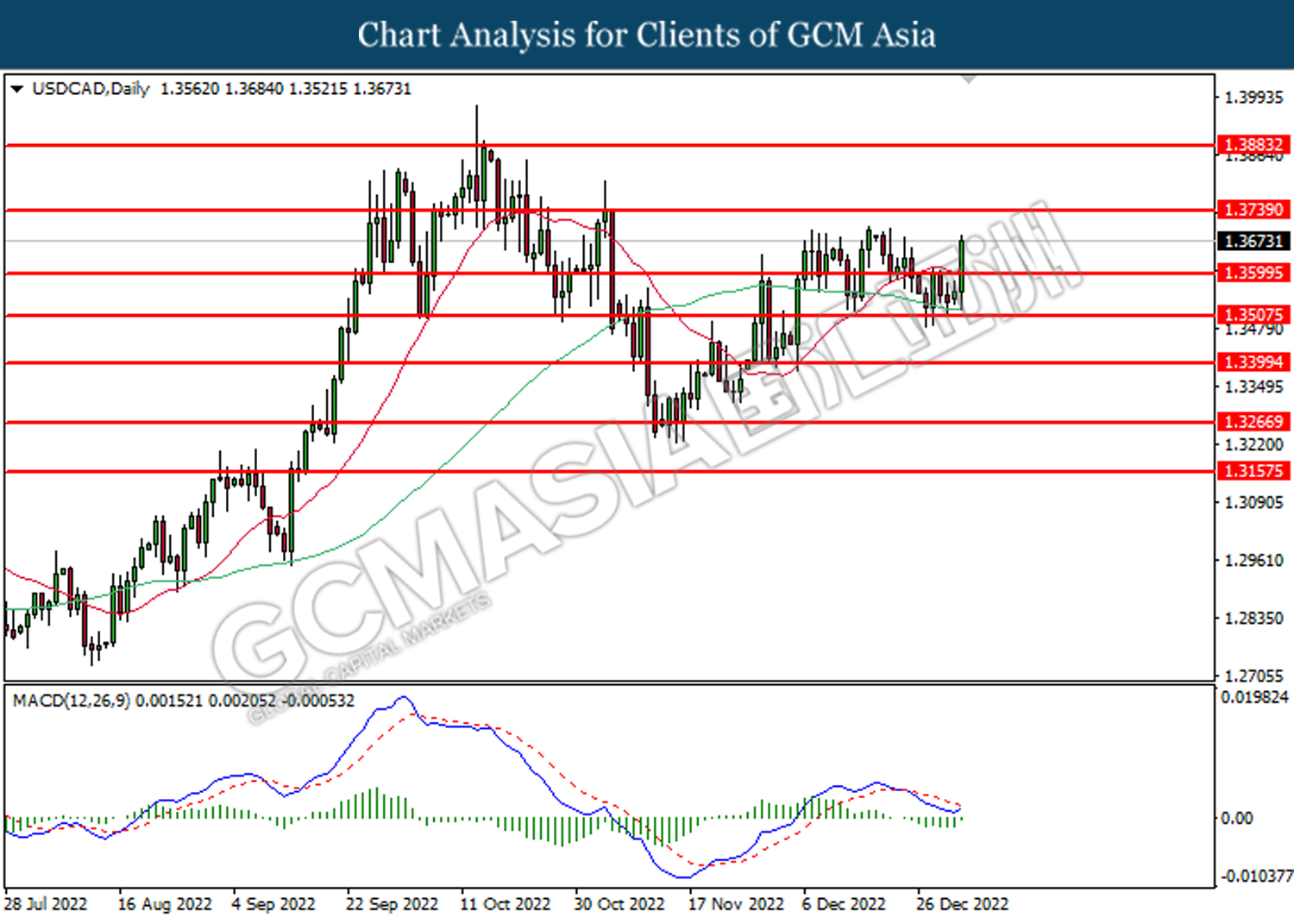

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher ad technical correction.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3155

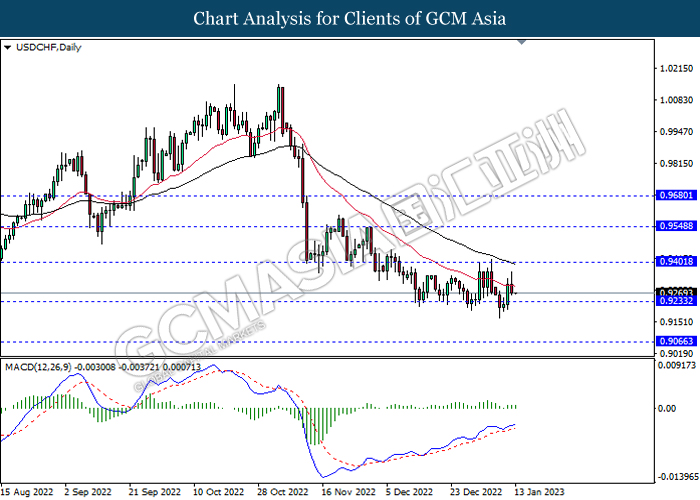

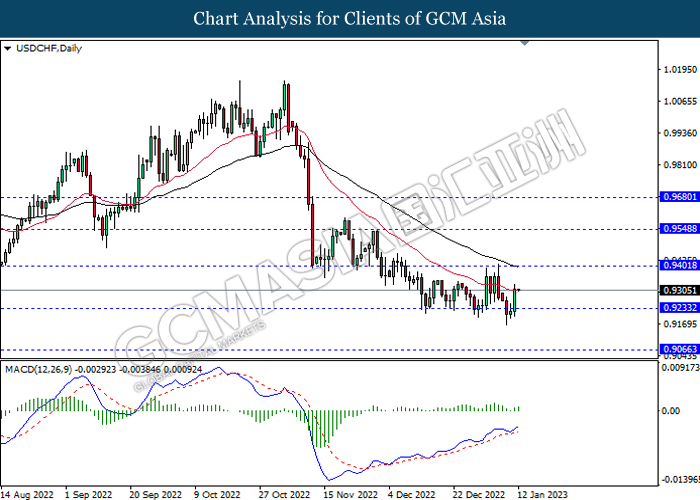

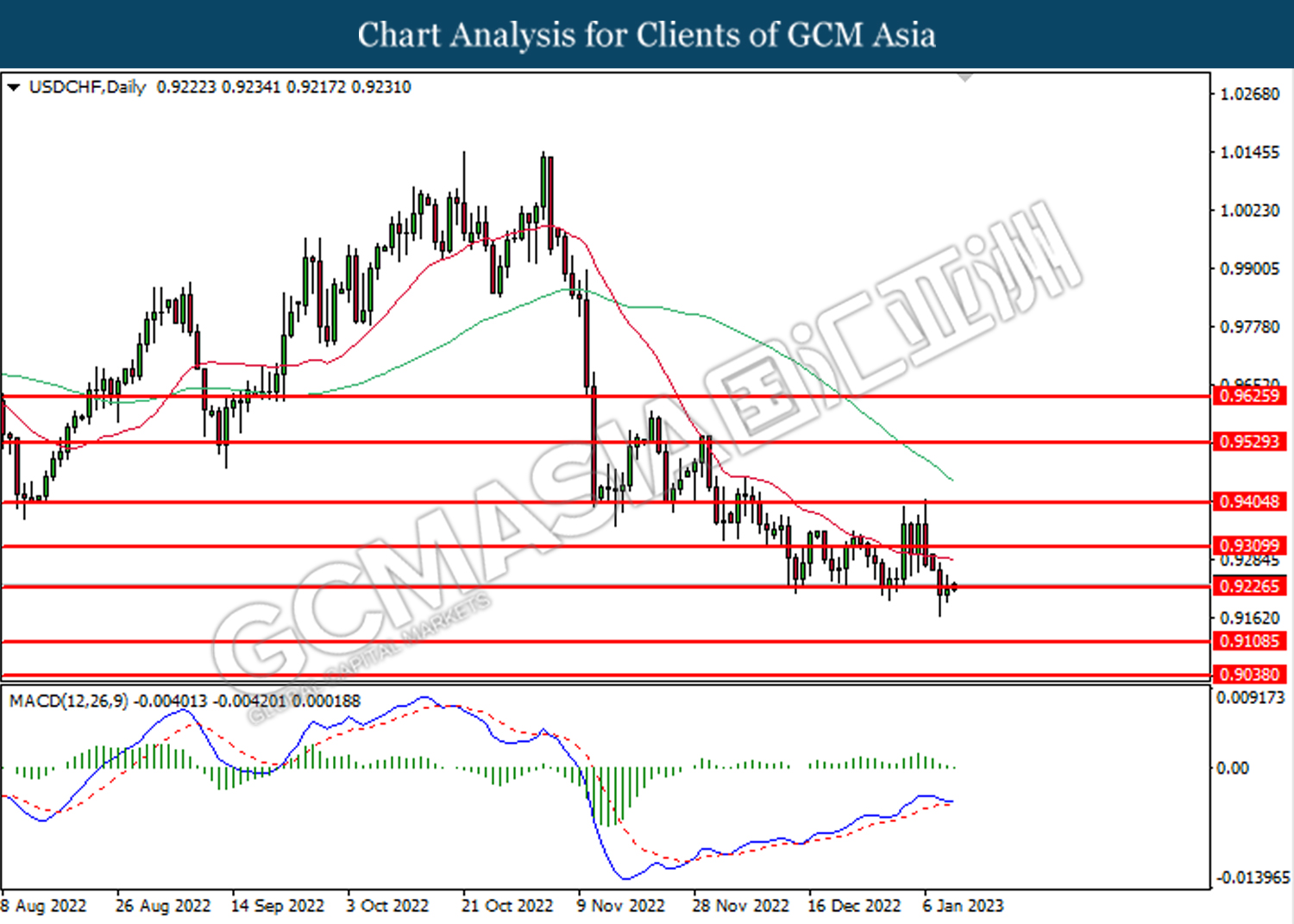

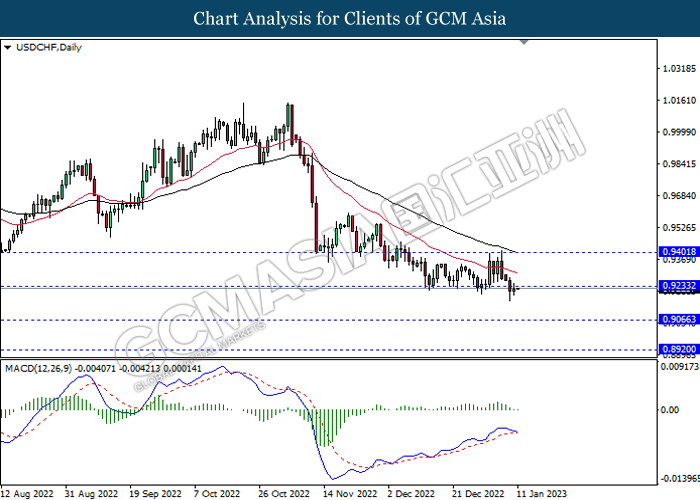

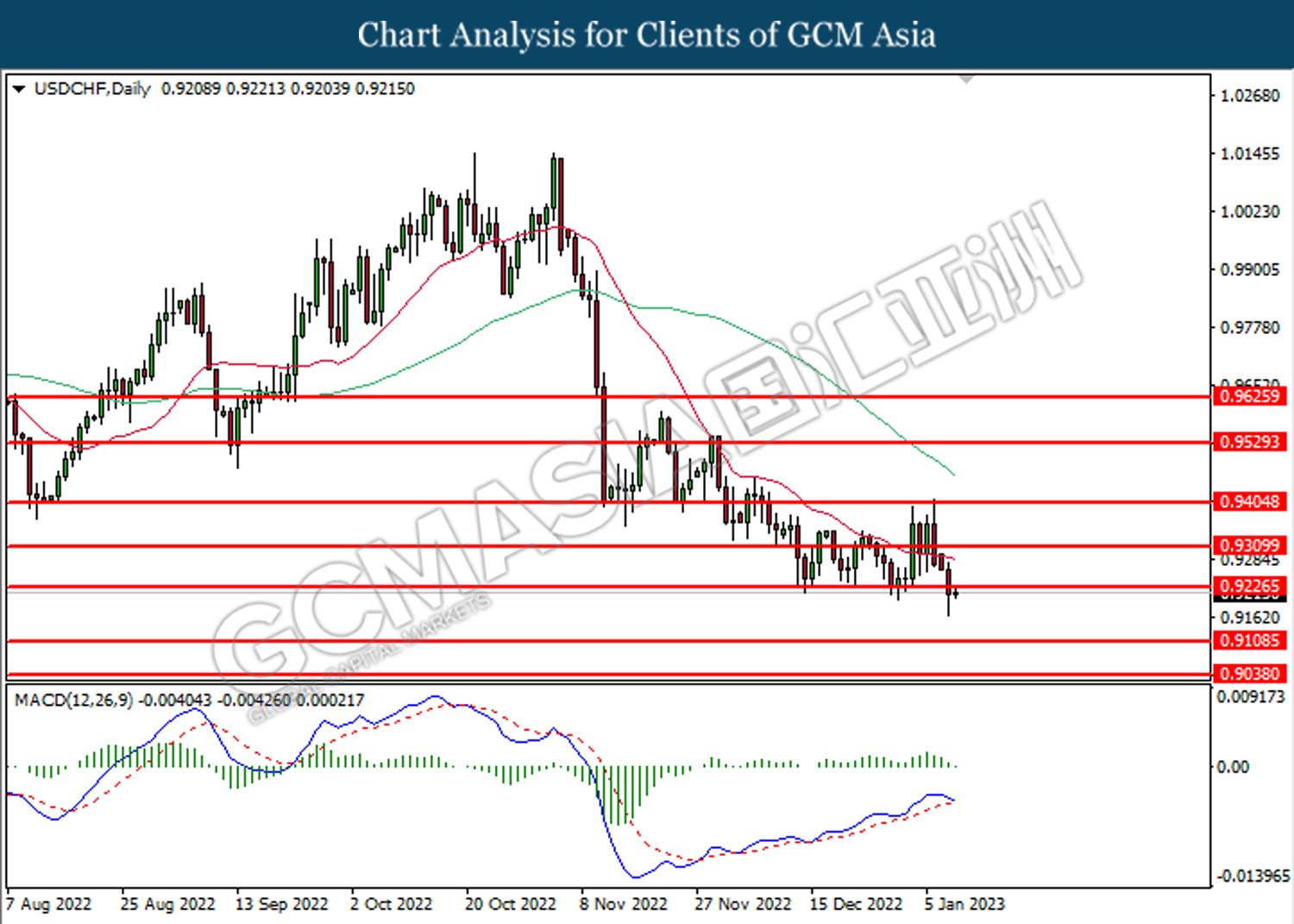

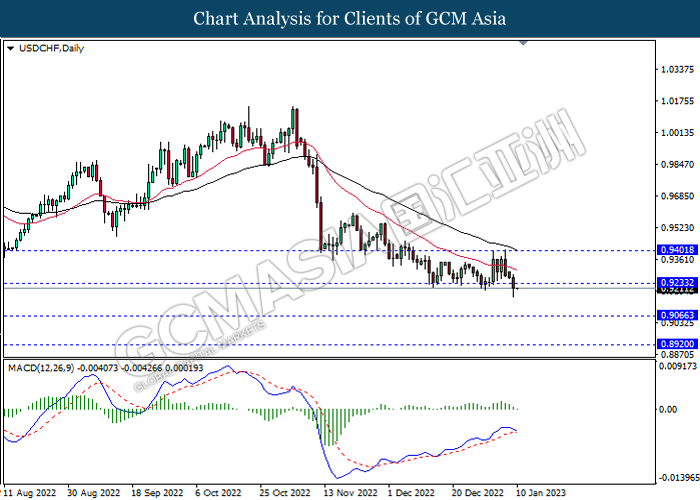

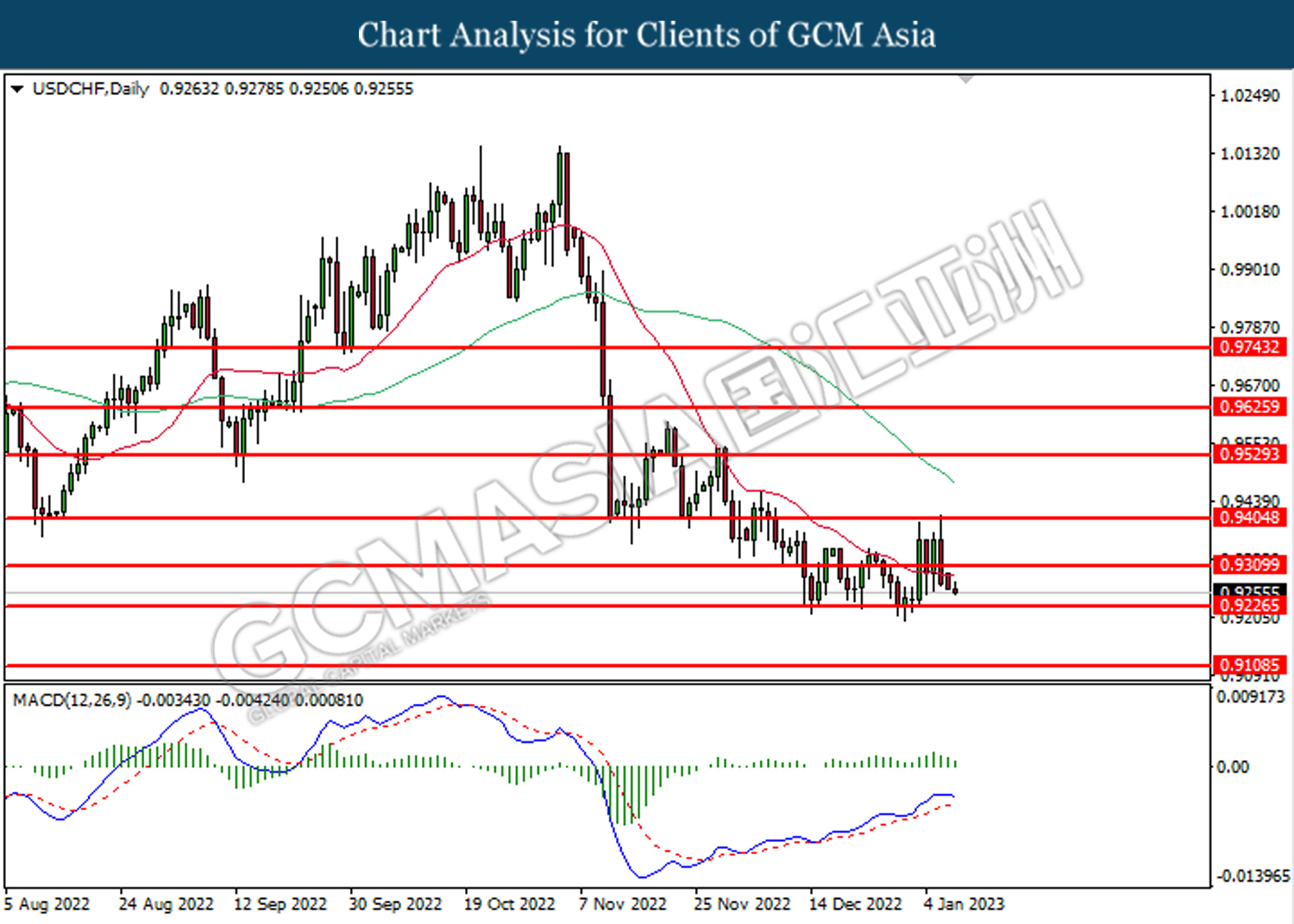

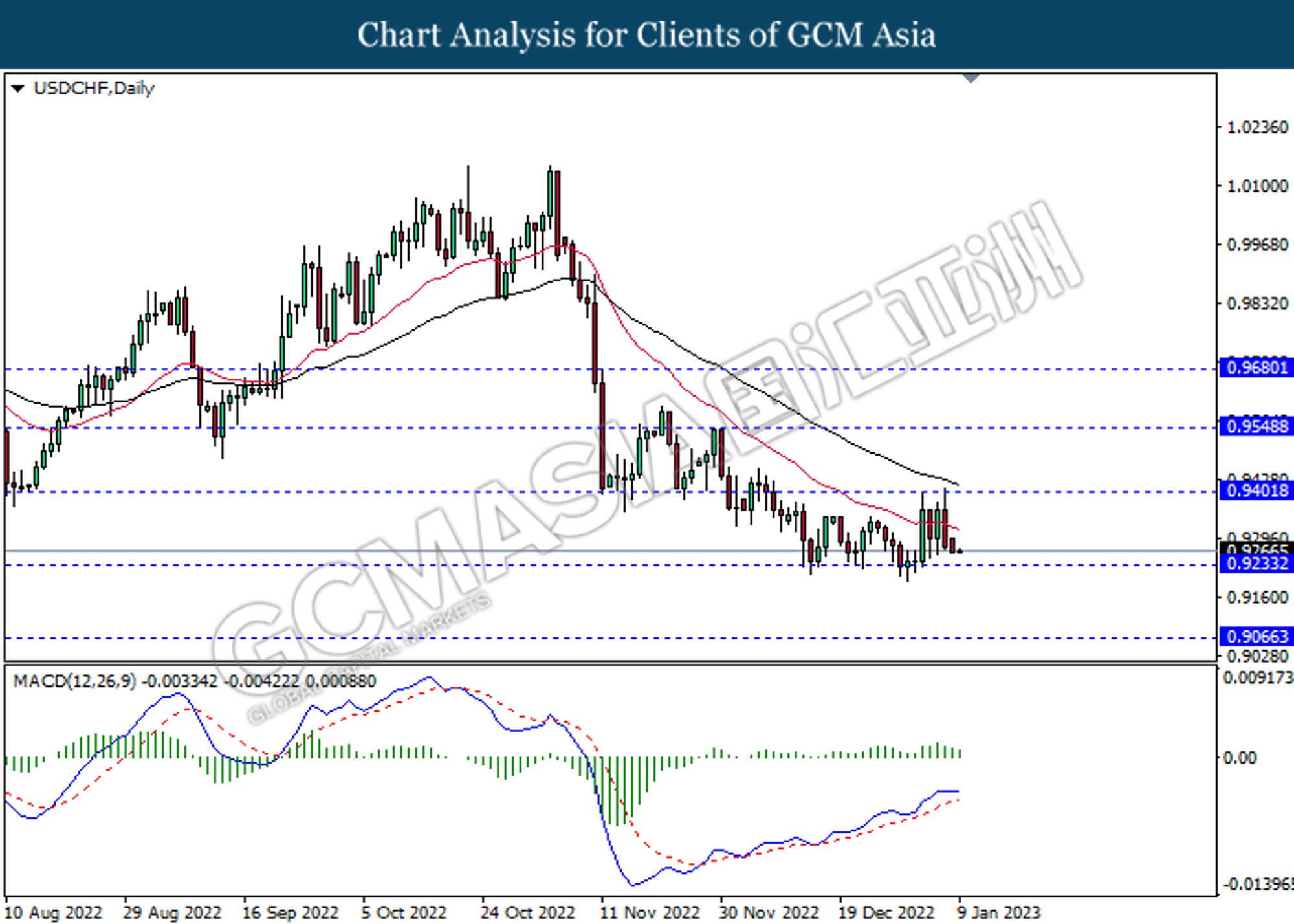

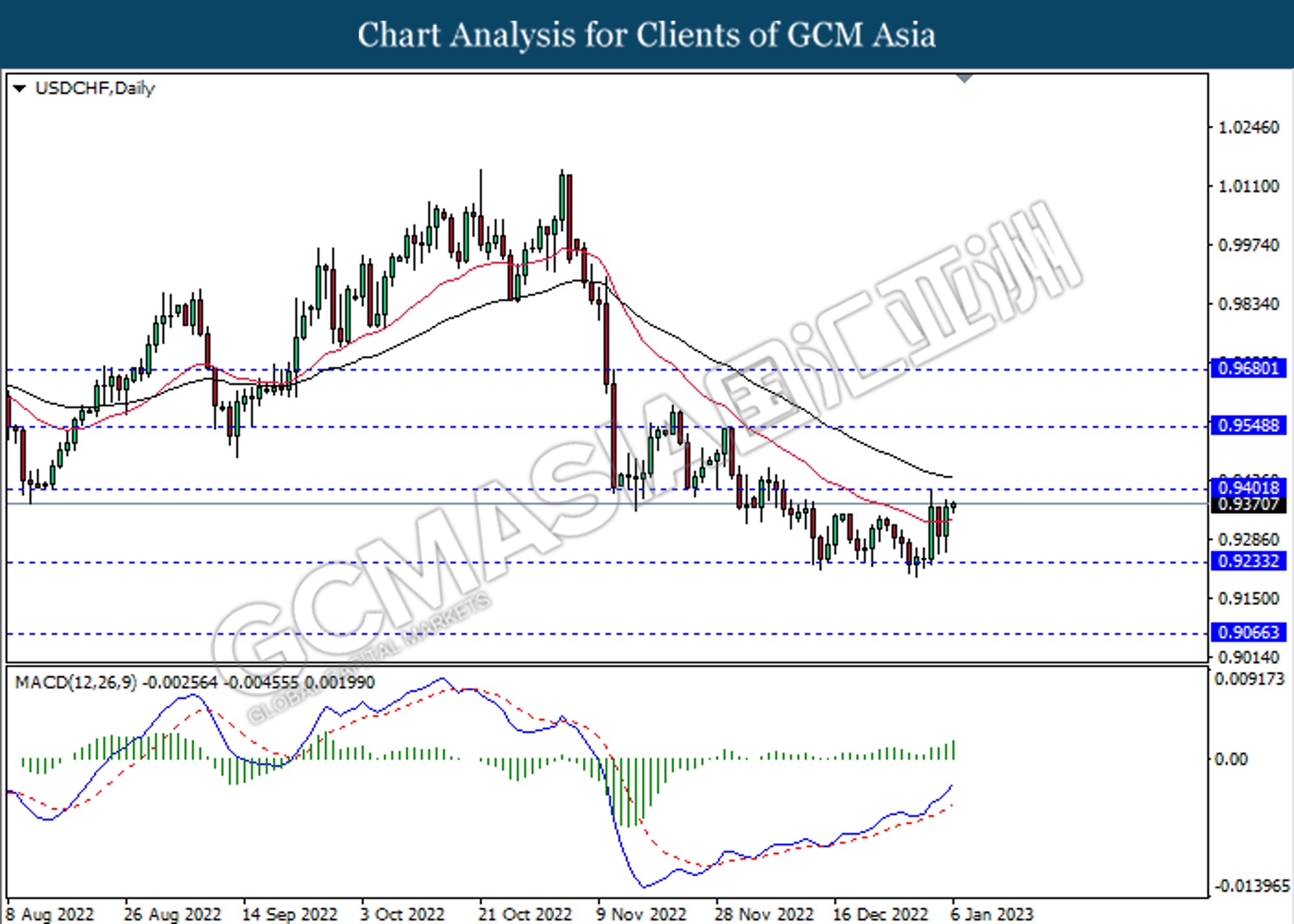

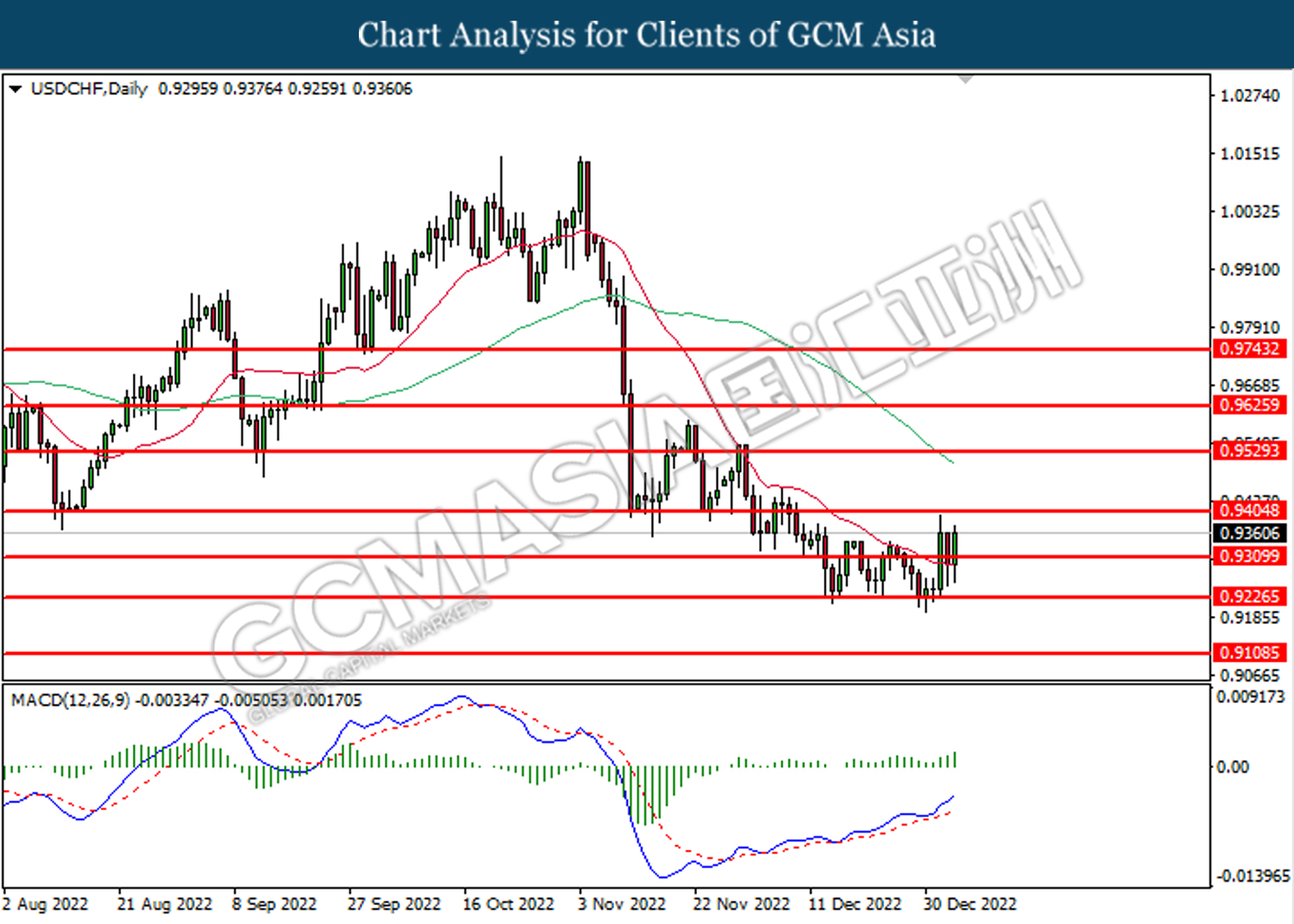

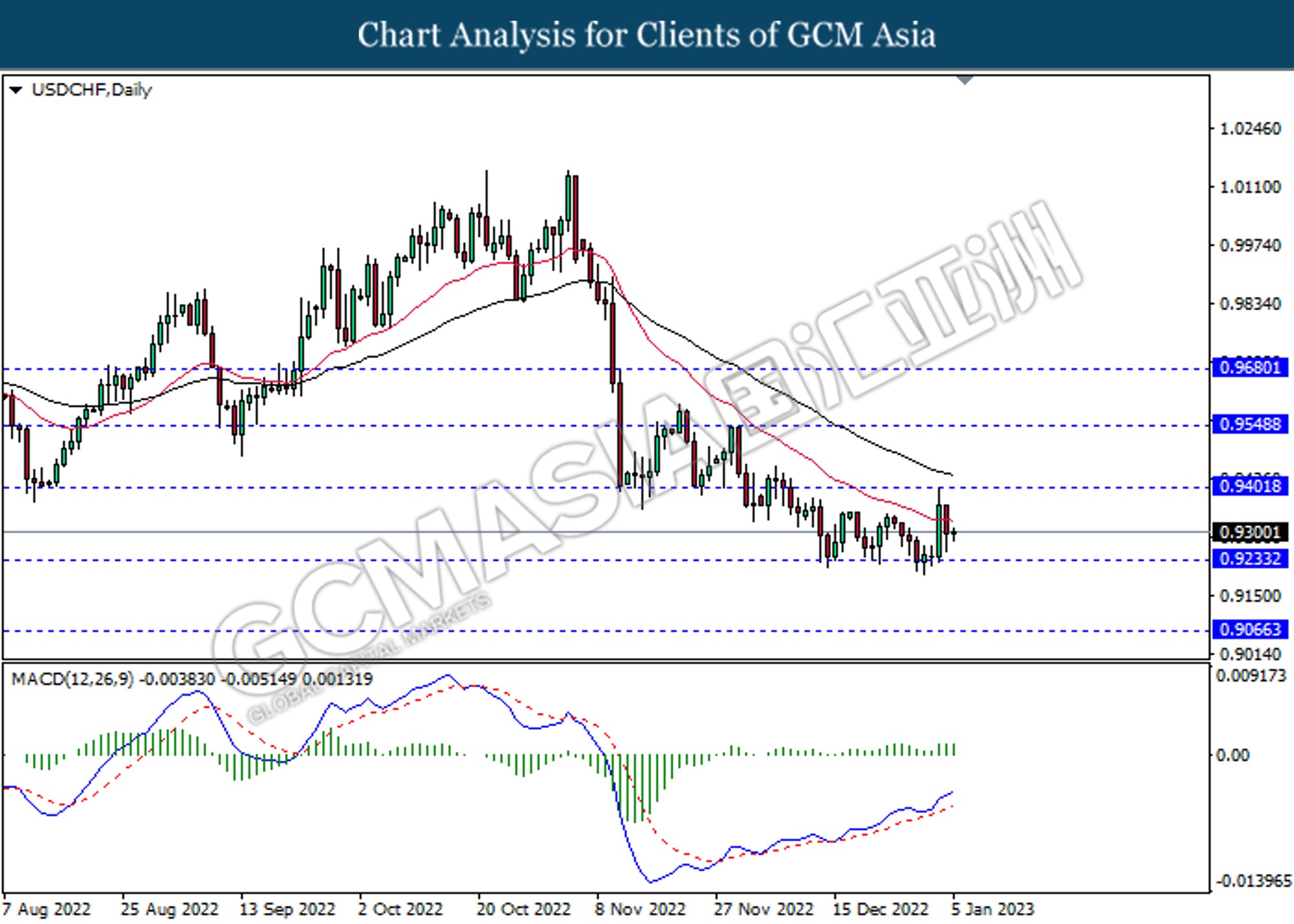

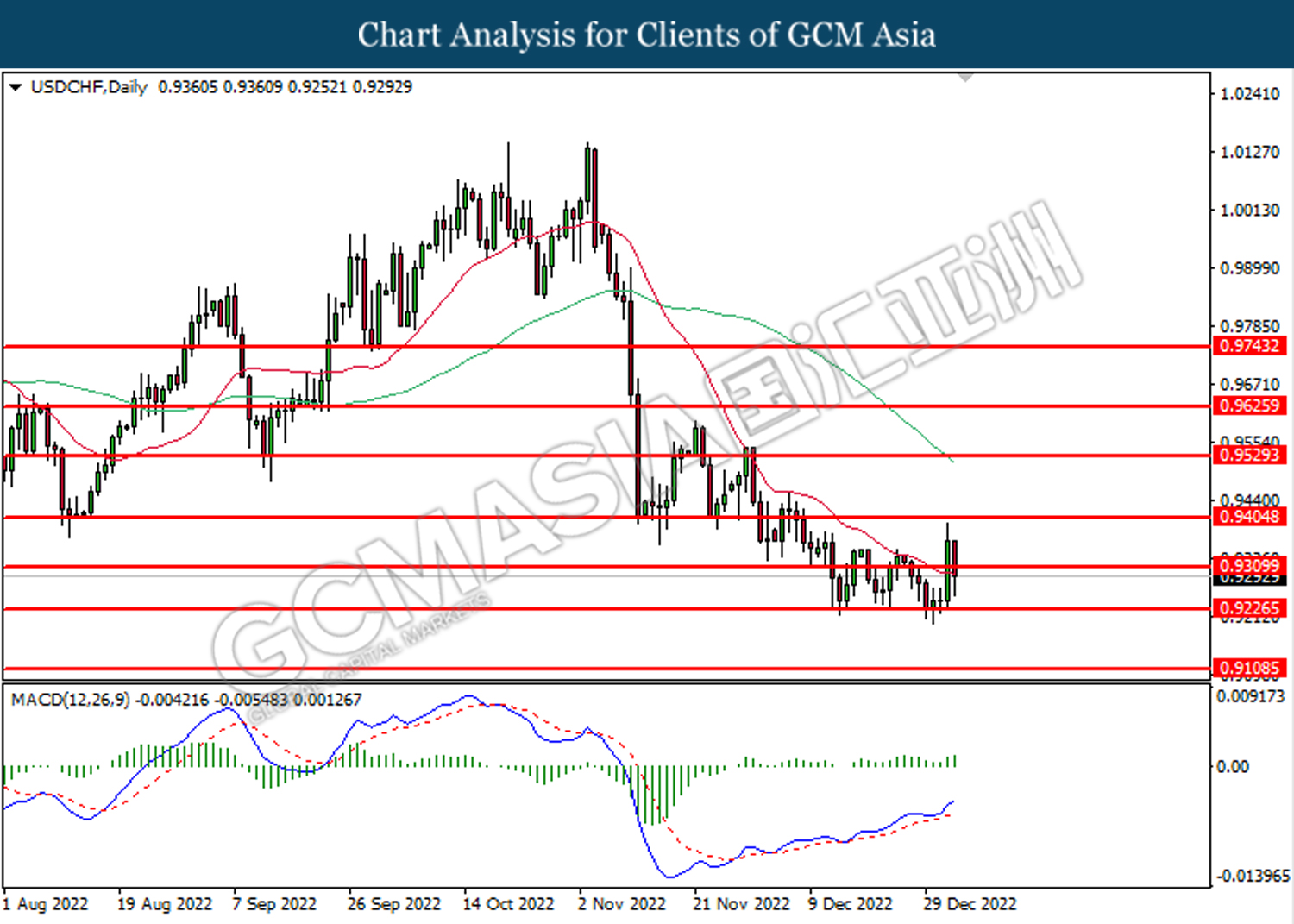

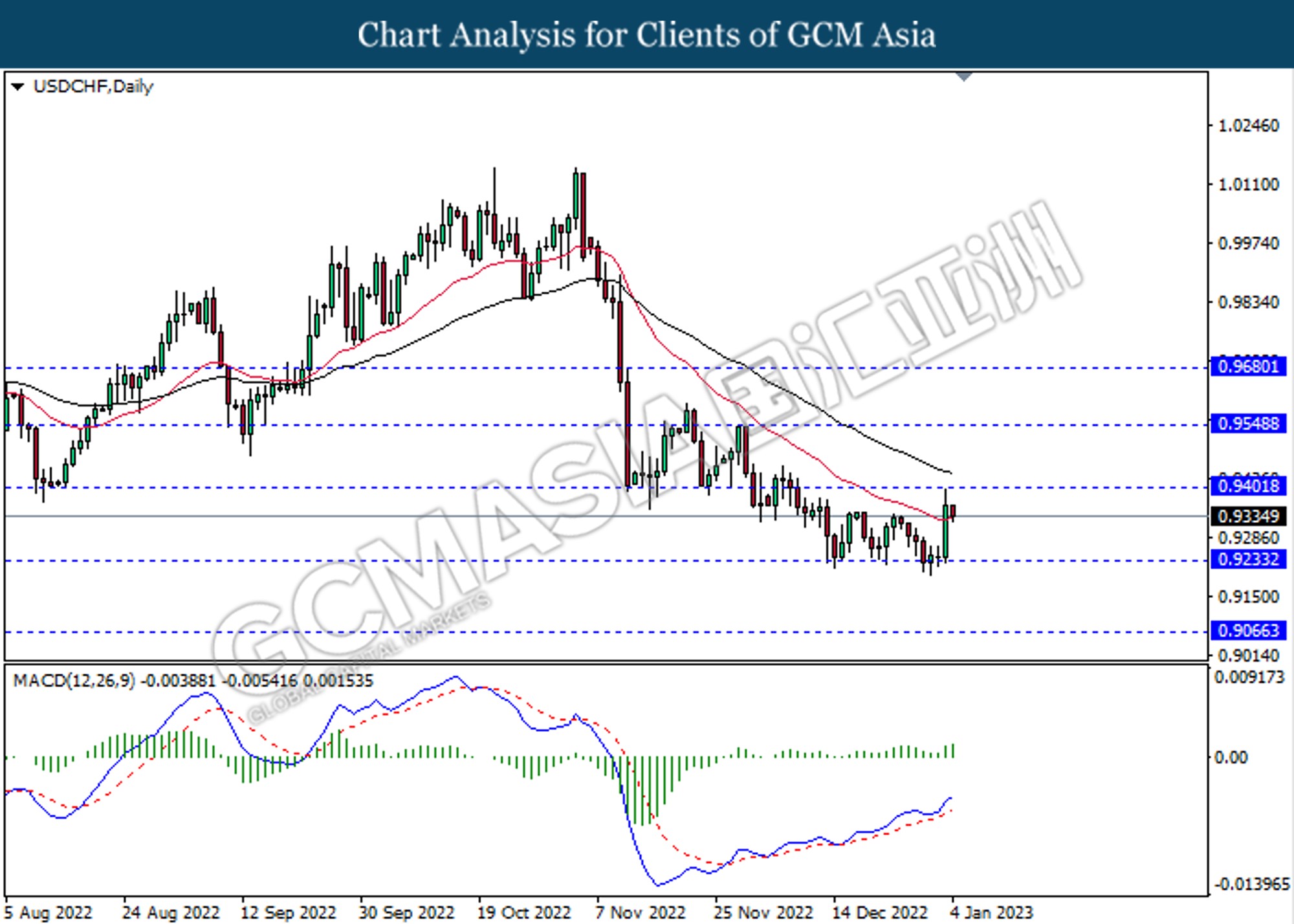

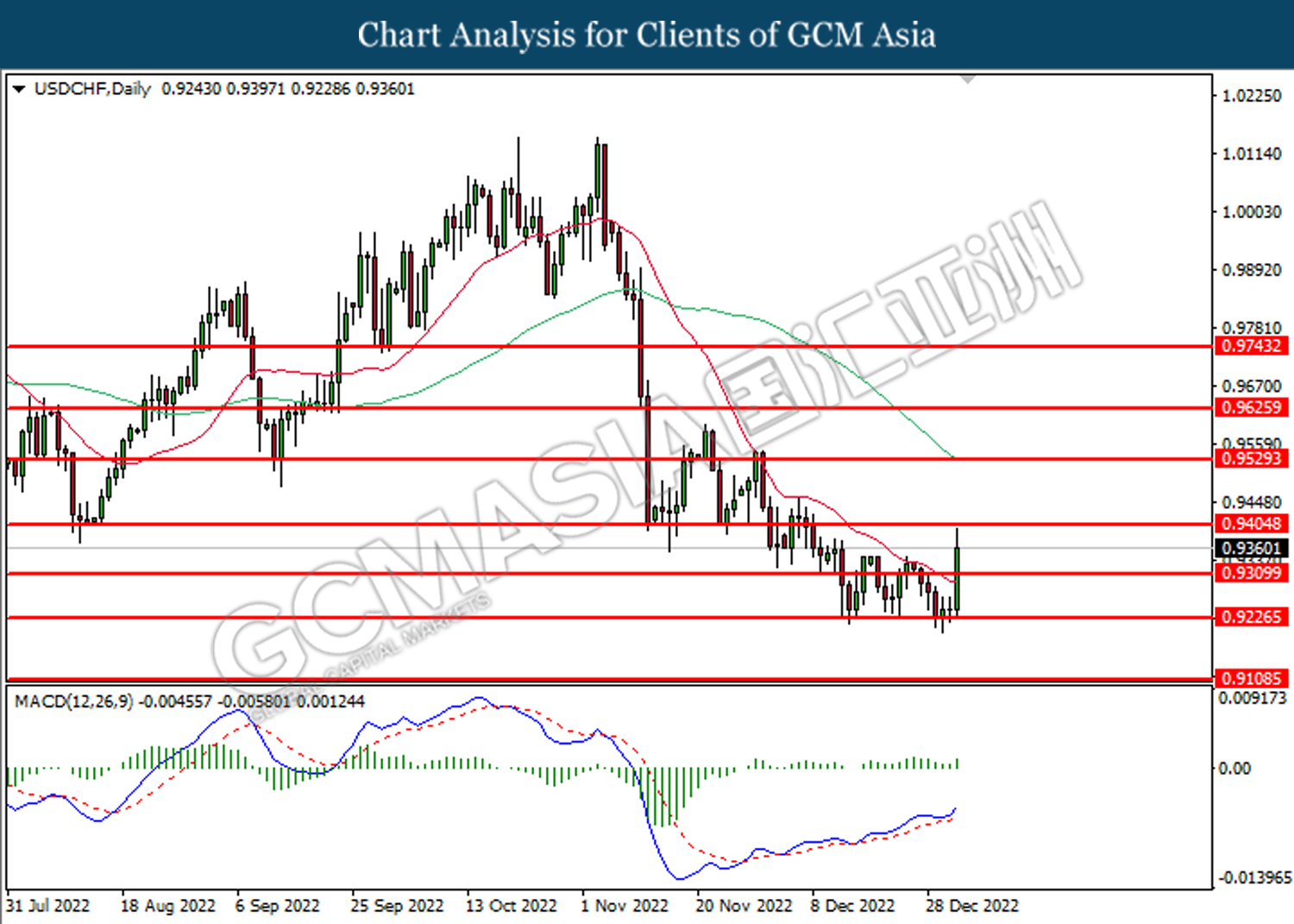

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

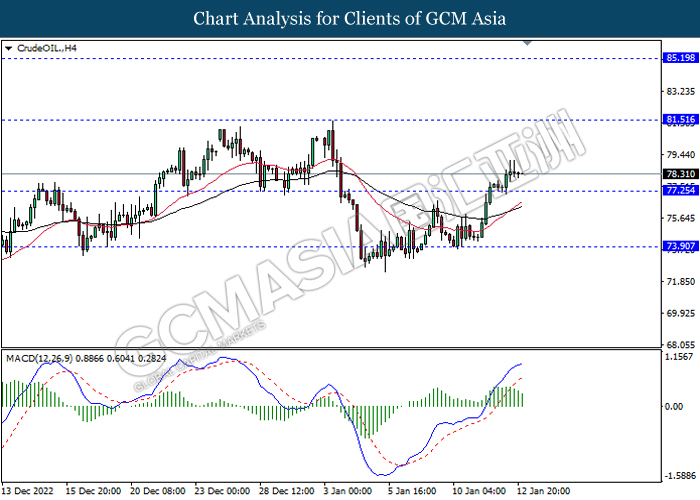

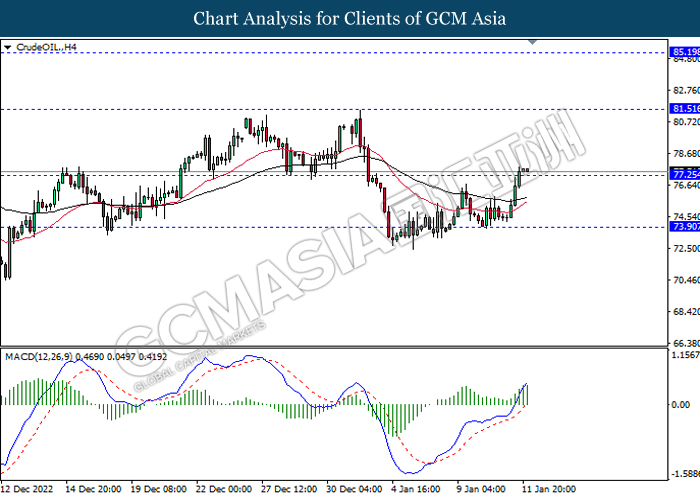

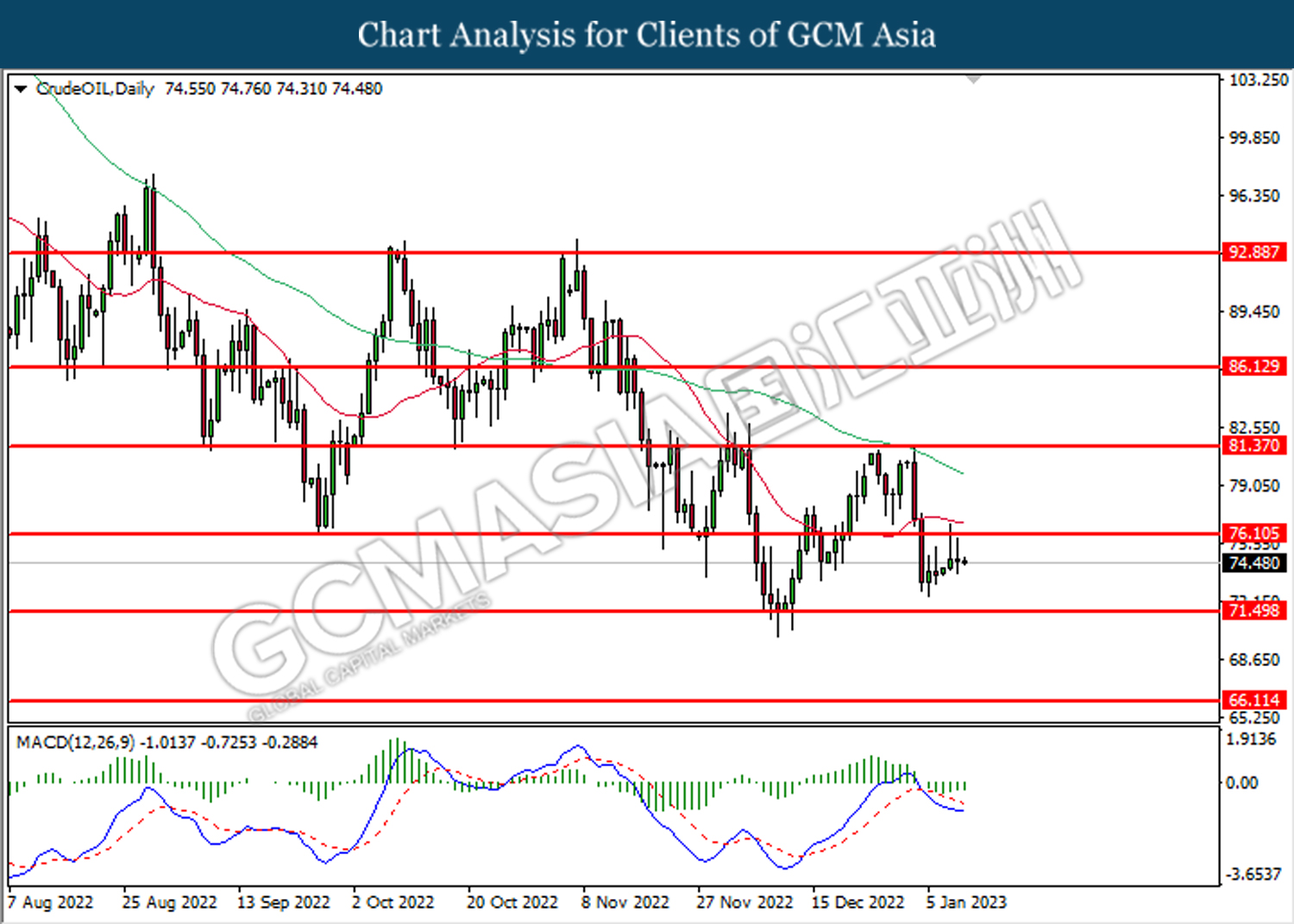

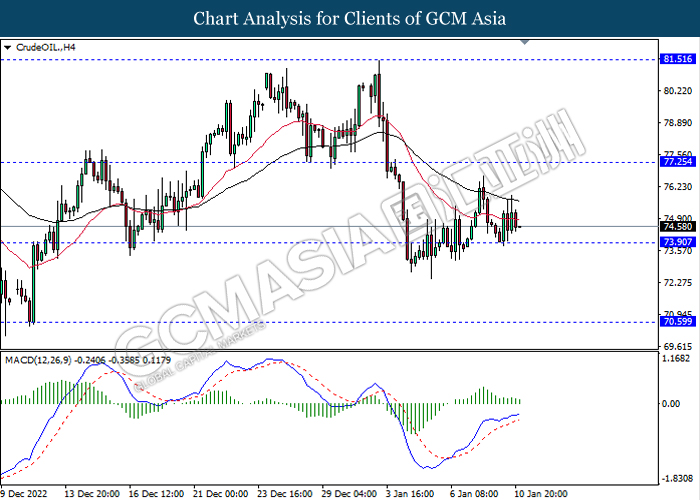

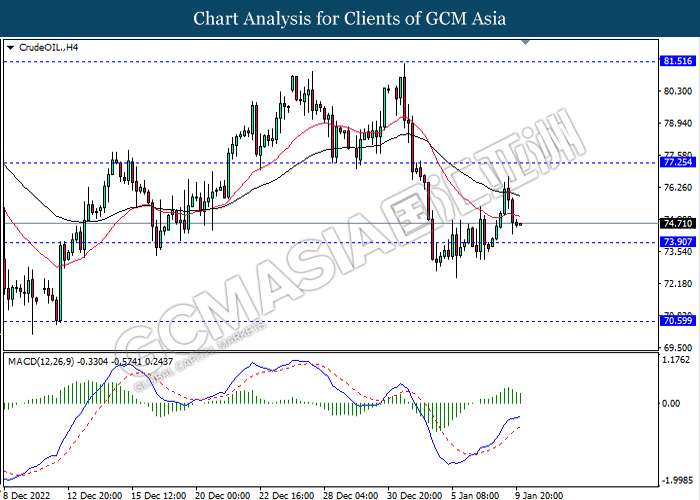

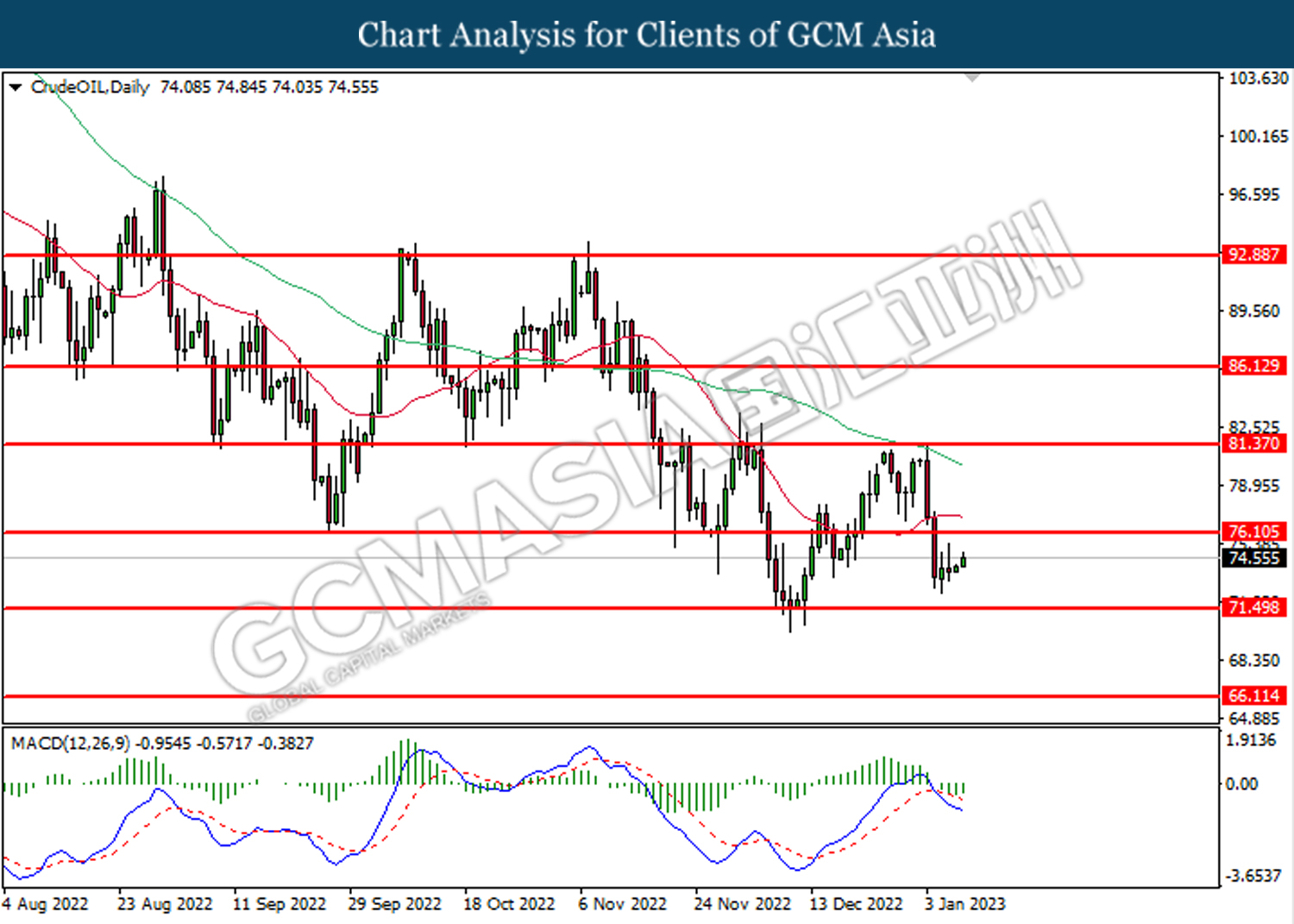

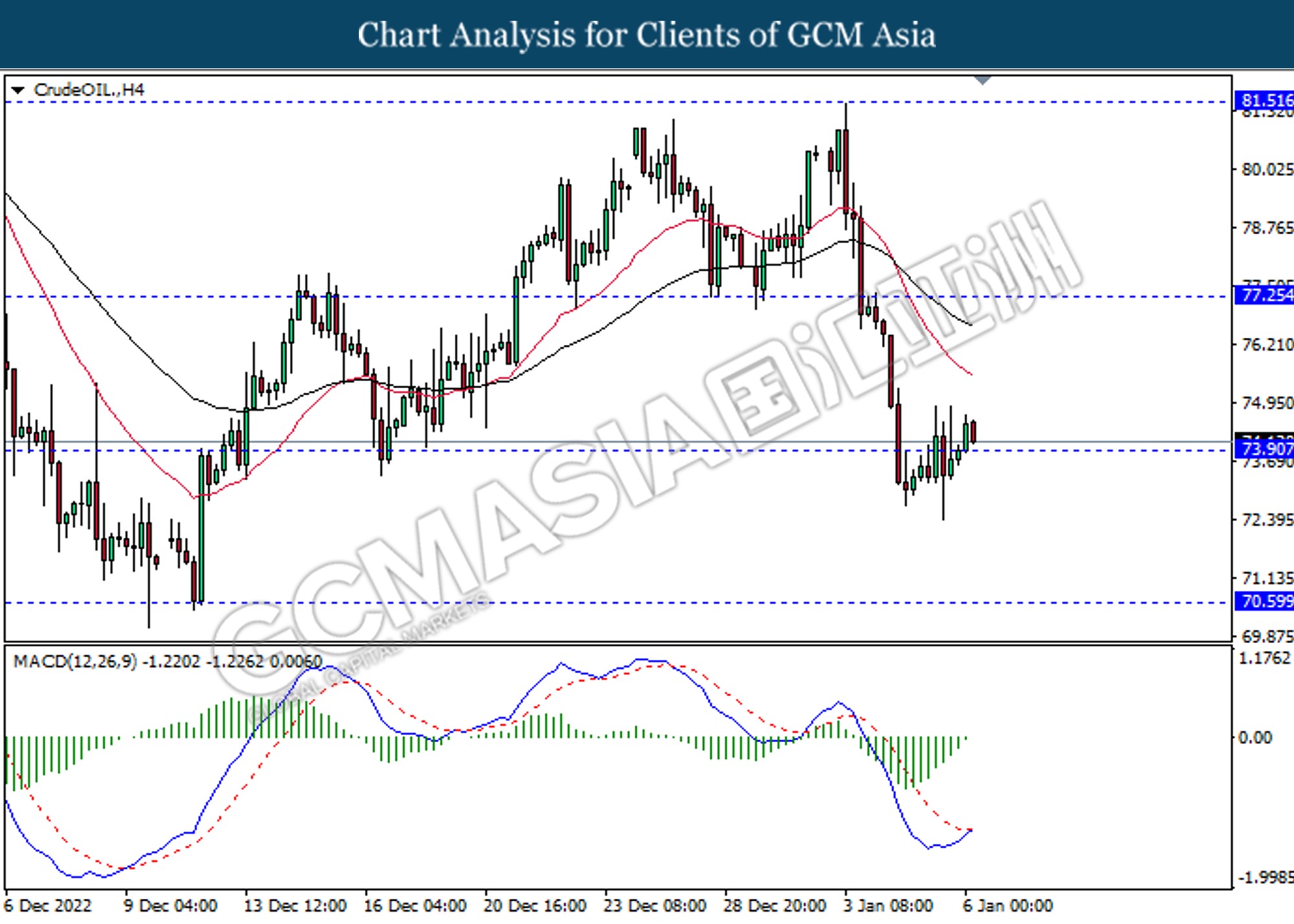

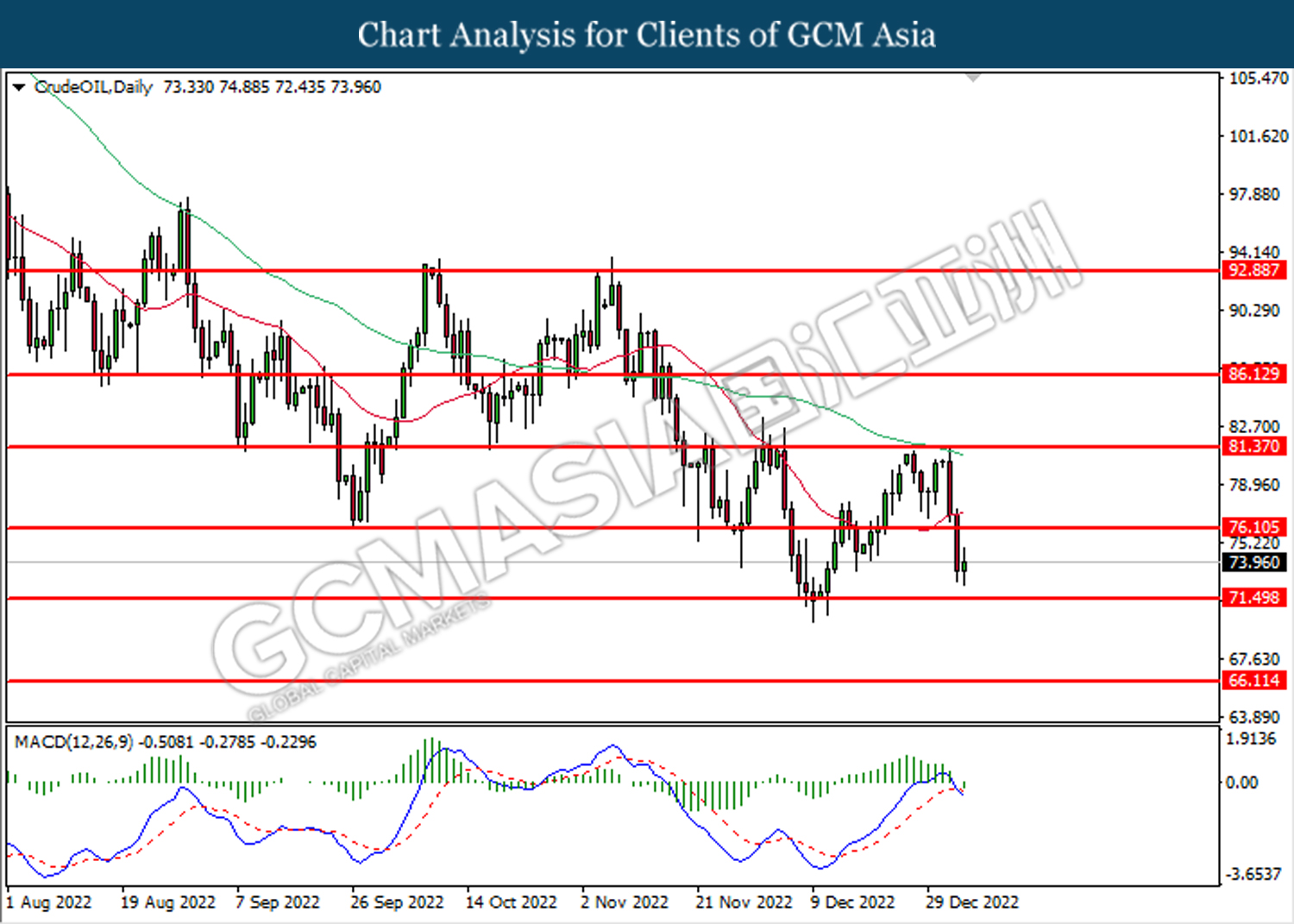

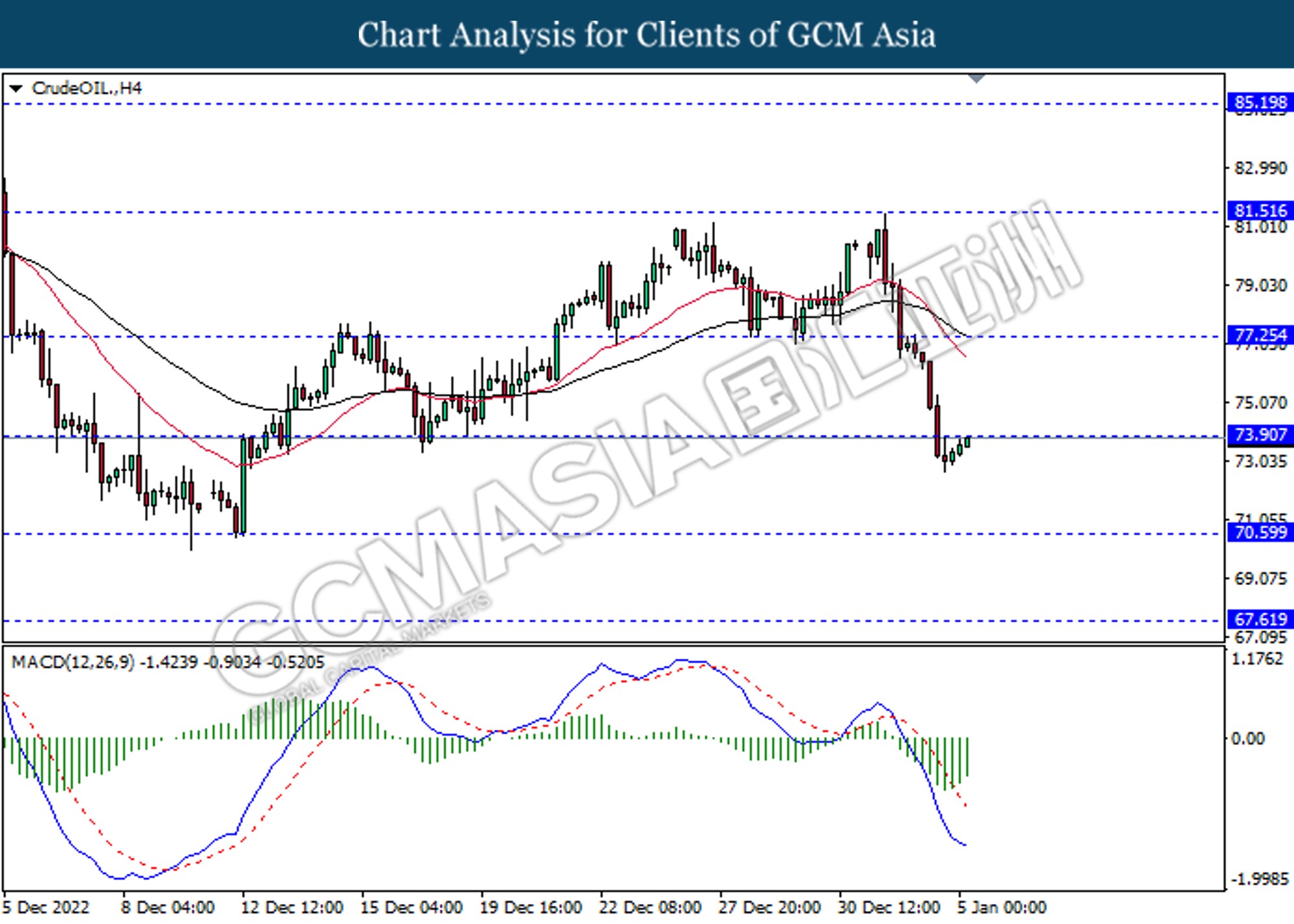

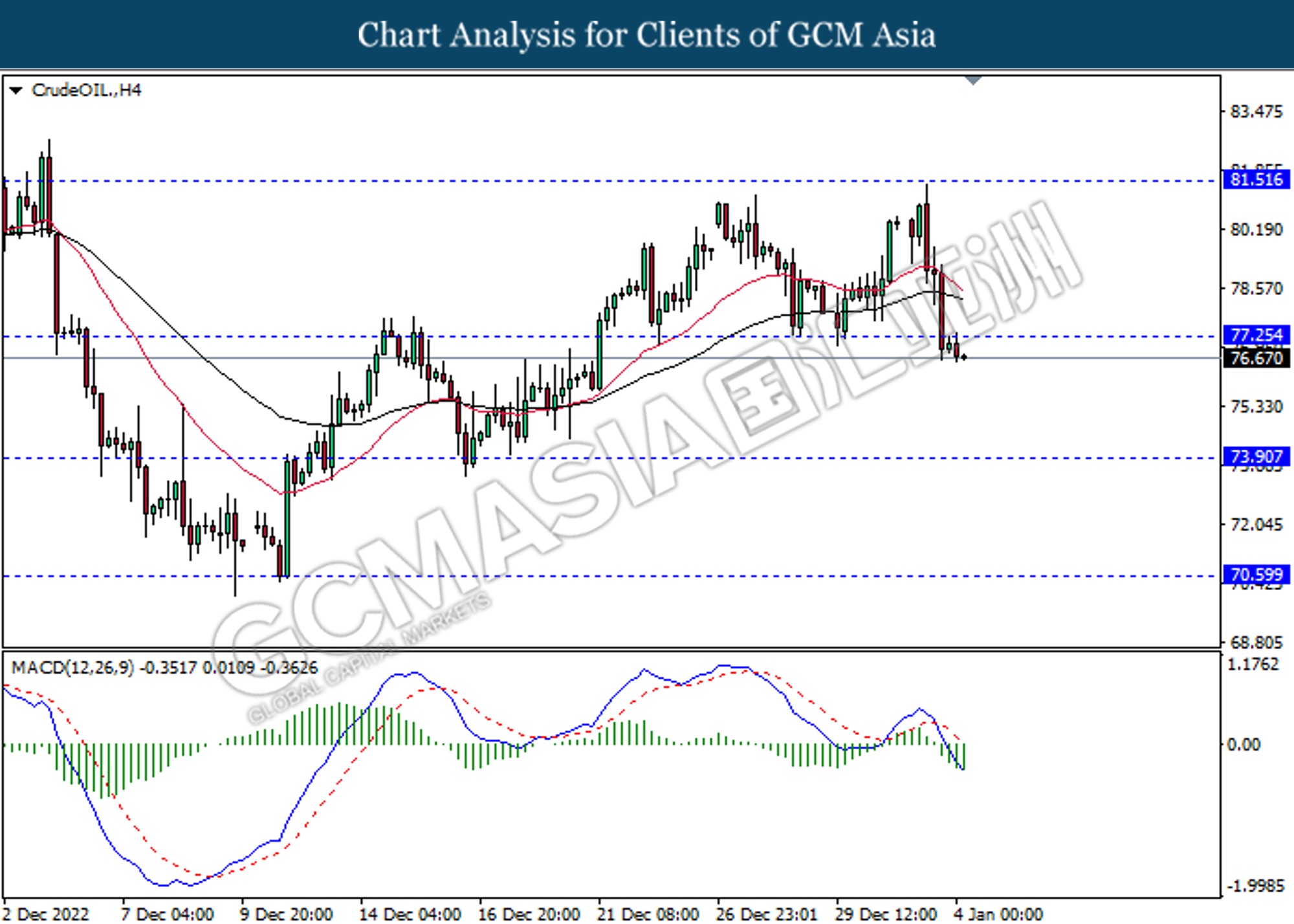

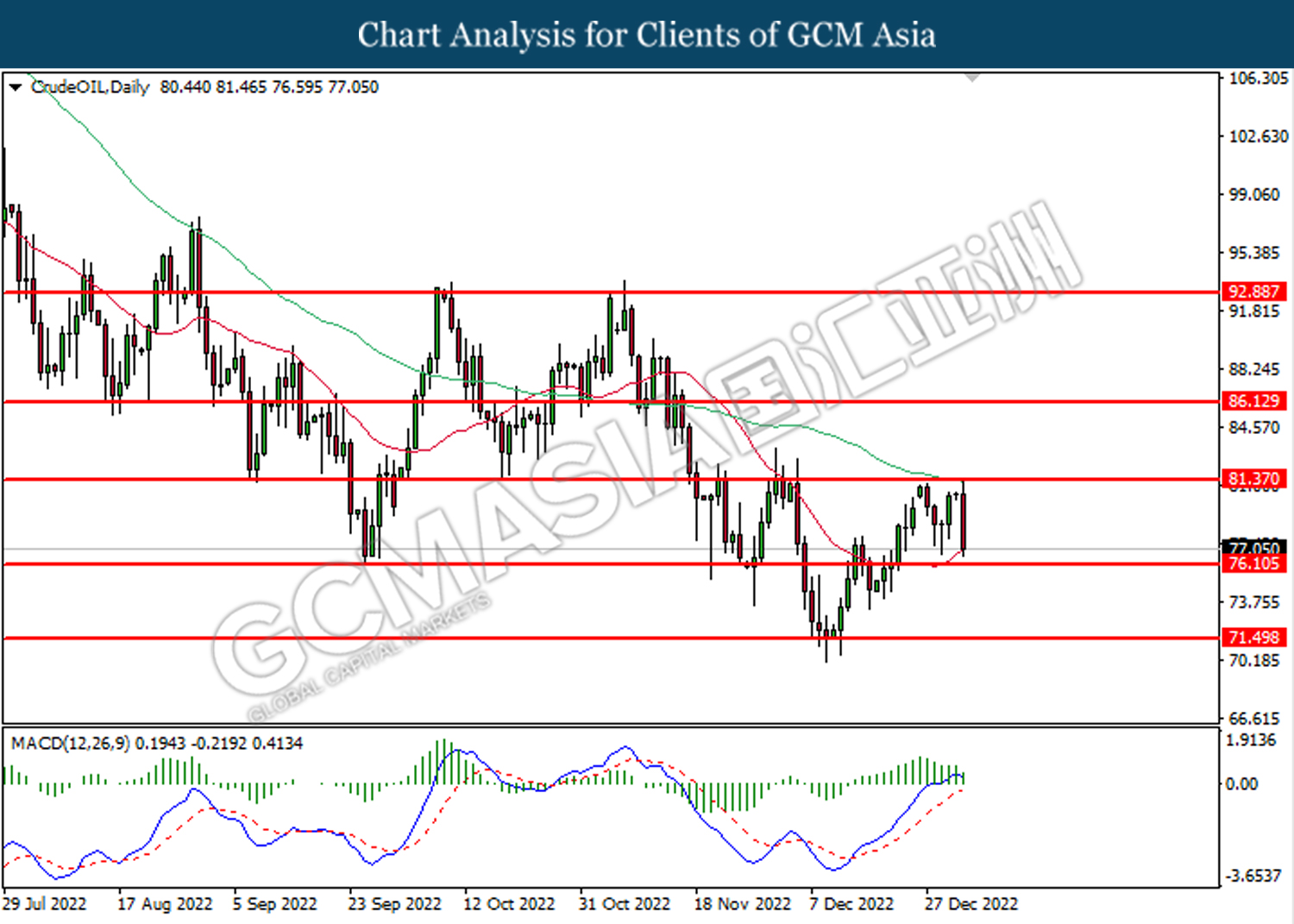

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

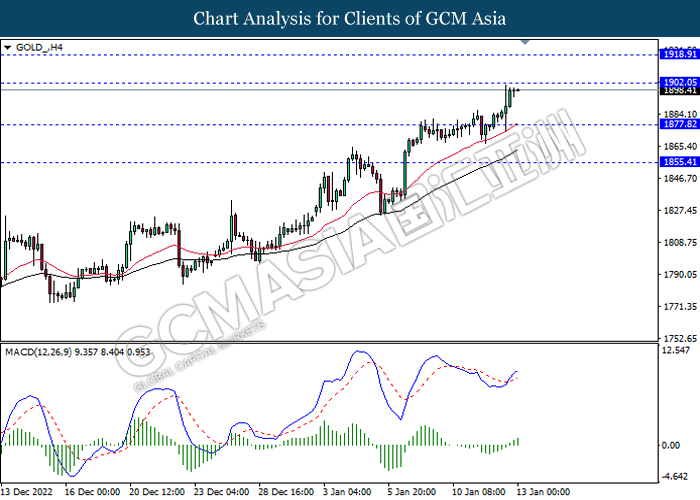

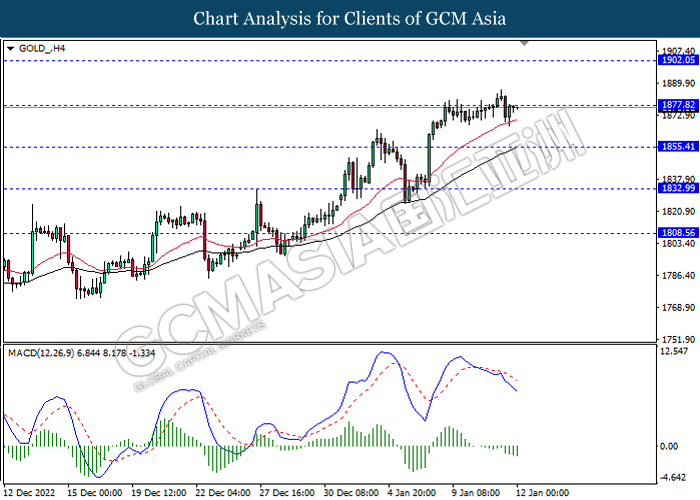

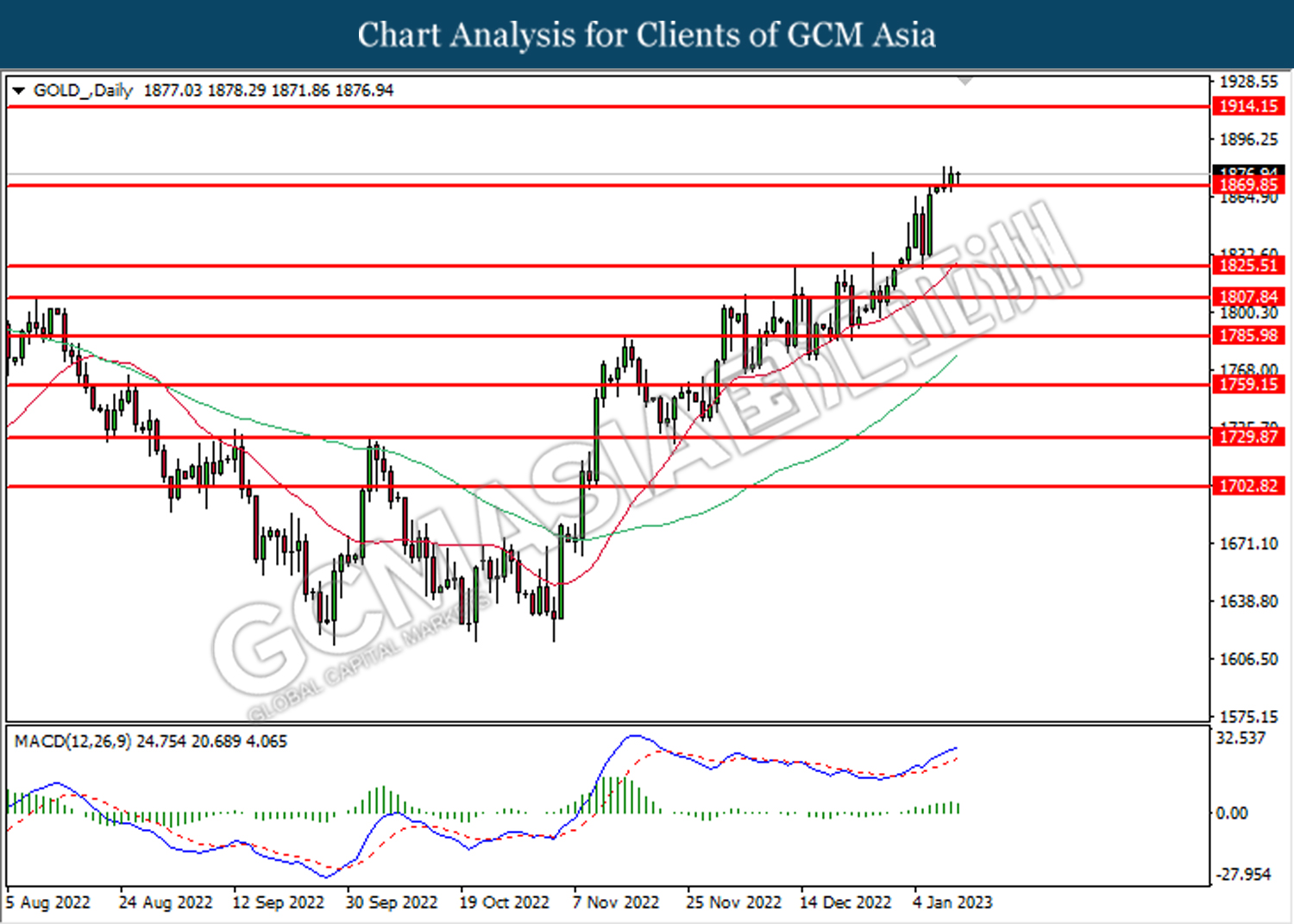

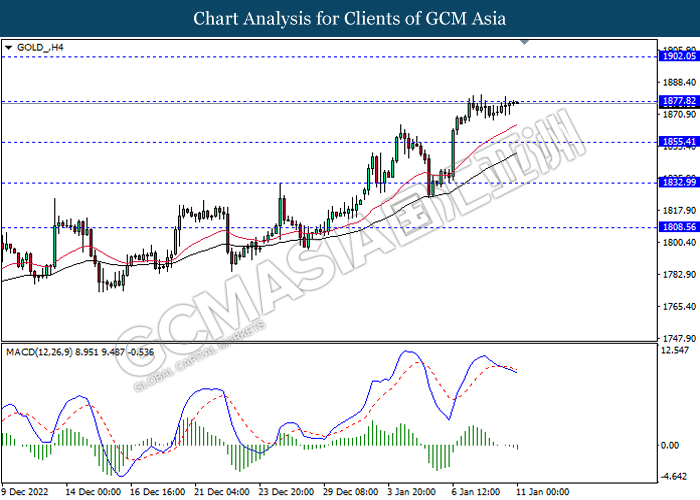

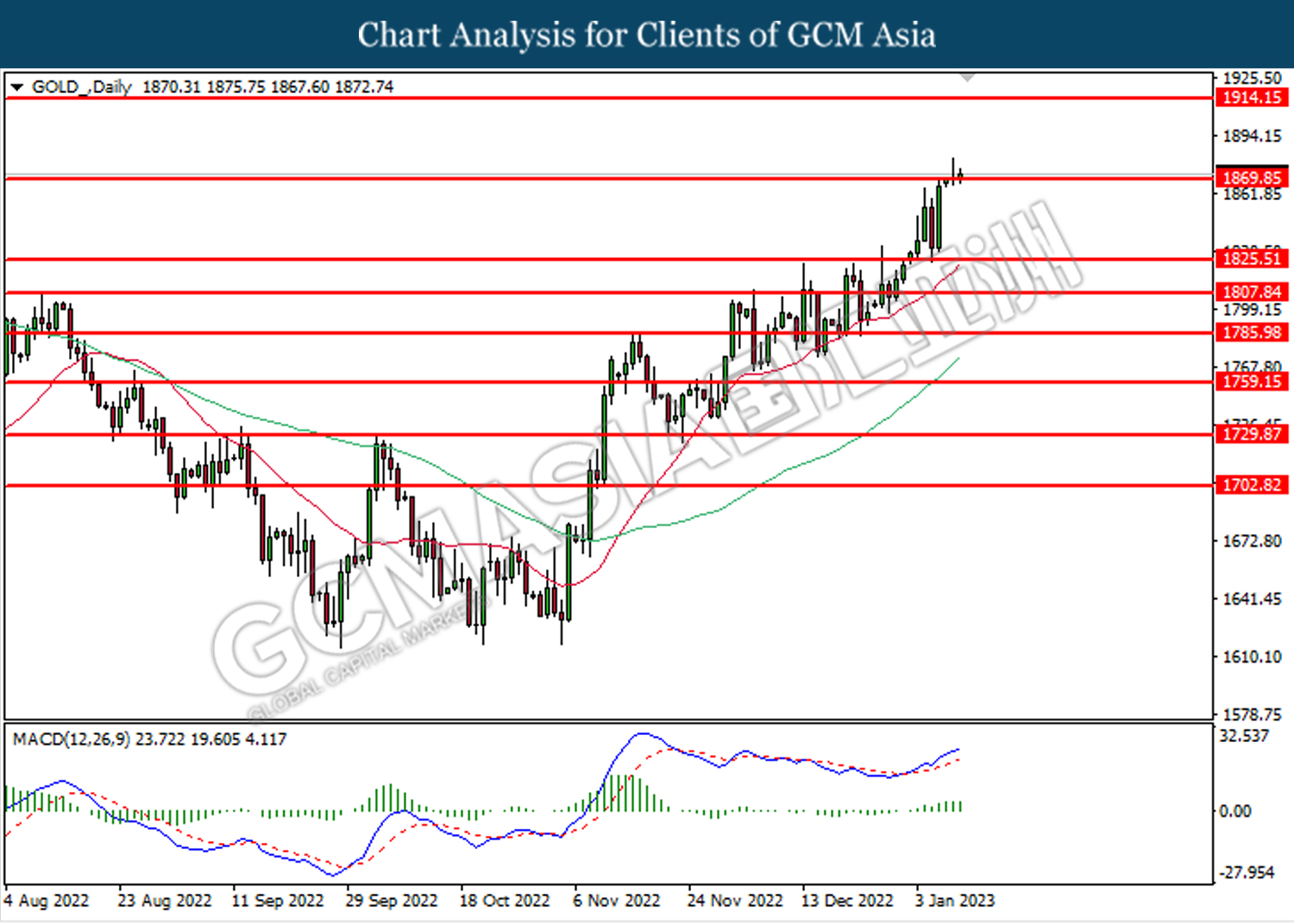

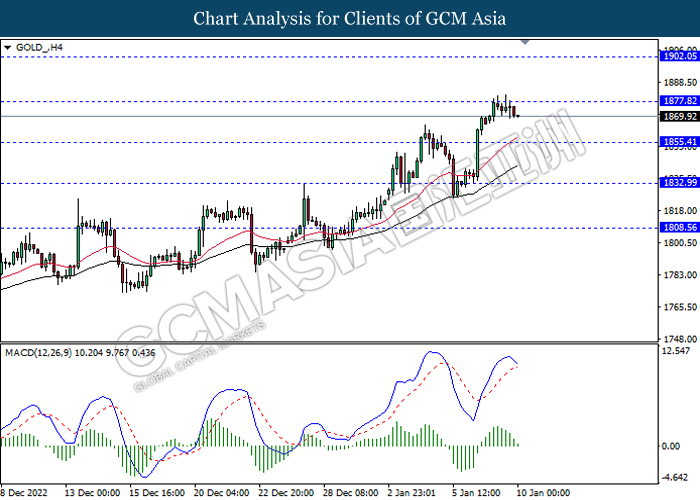

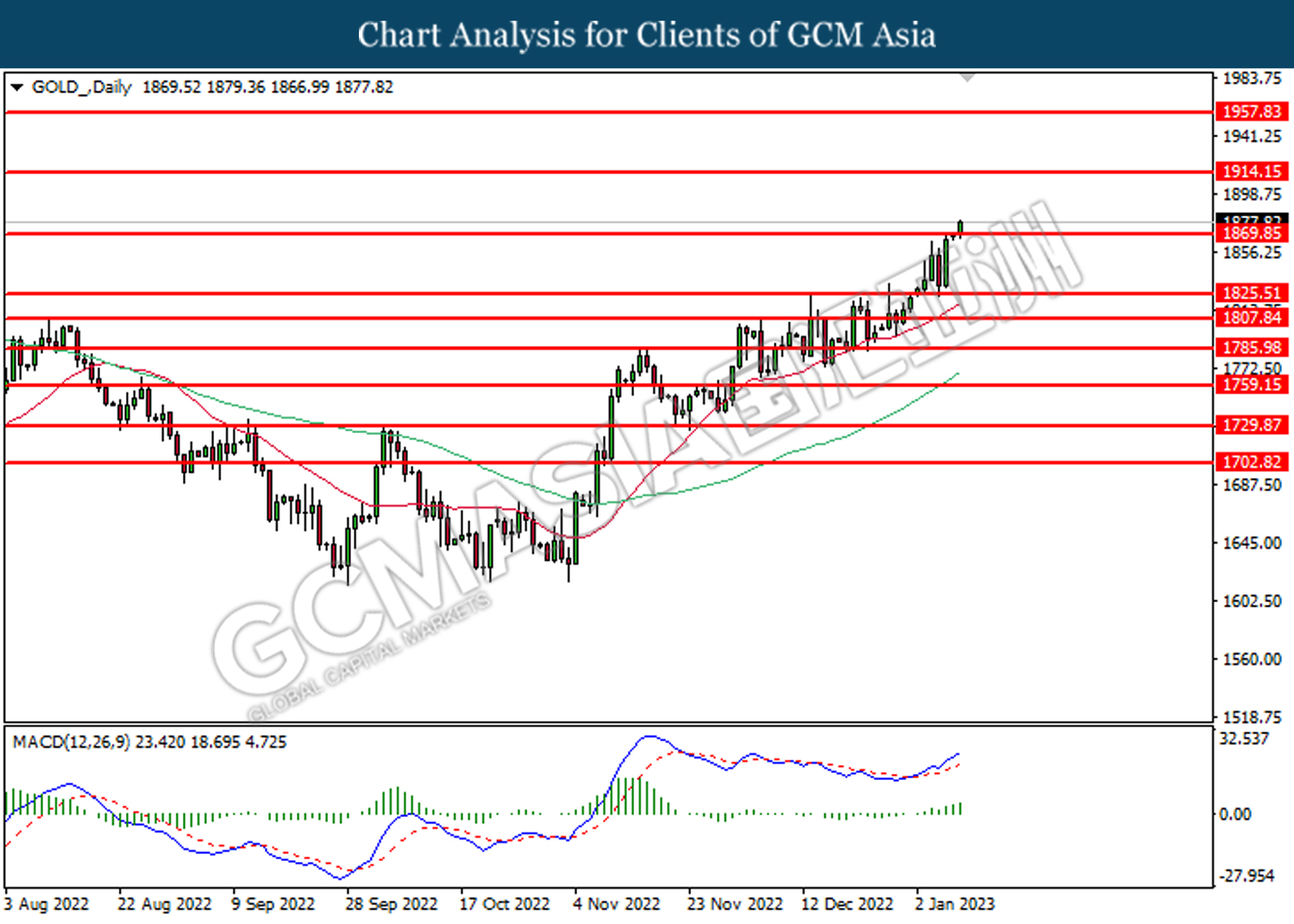

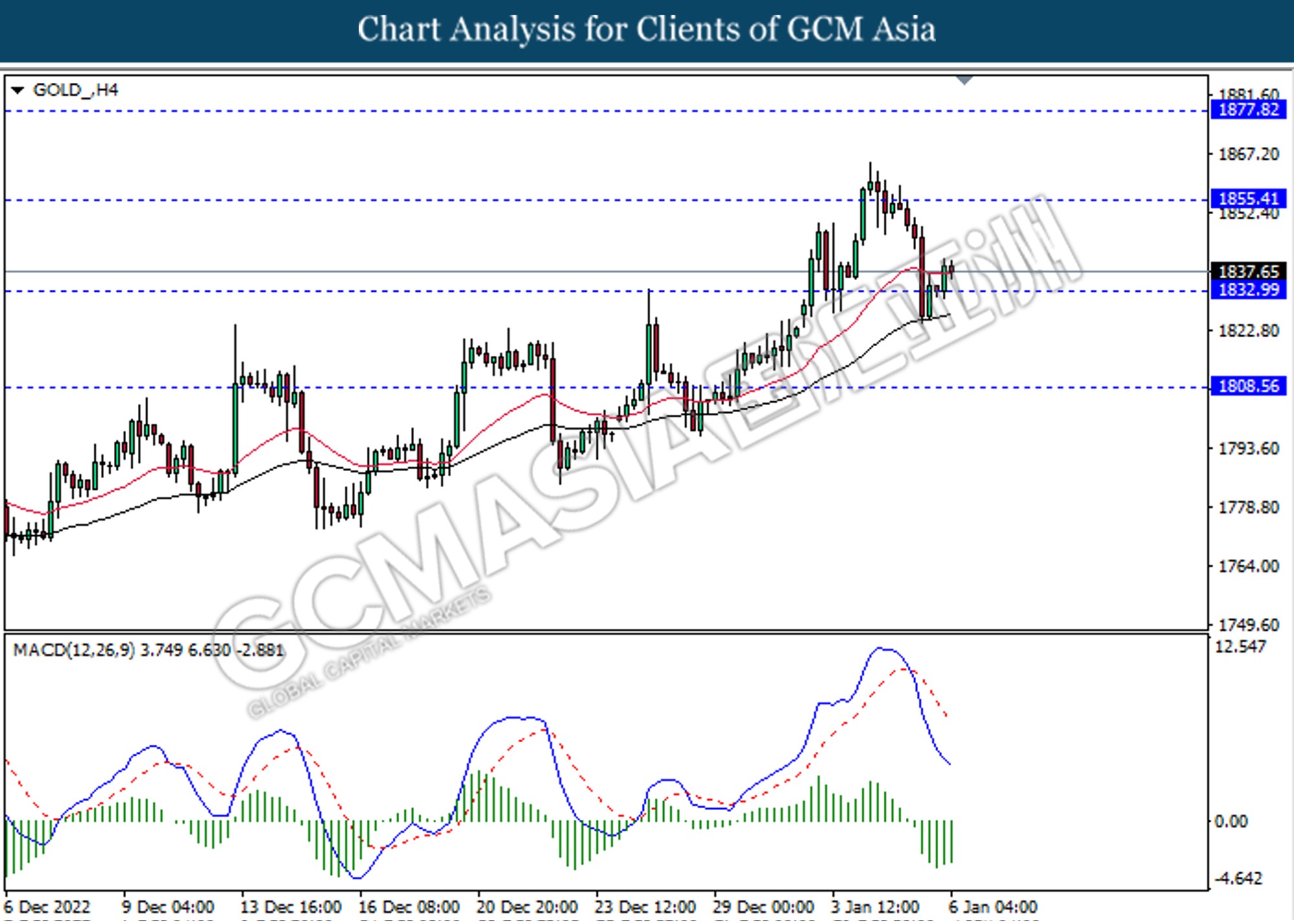

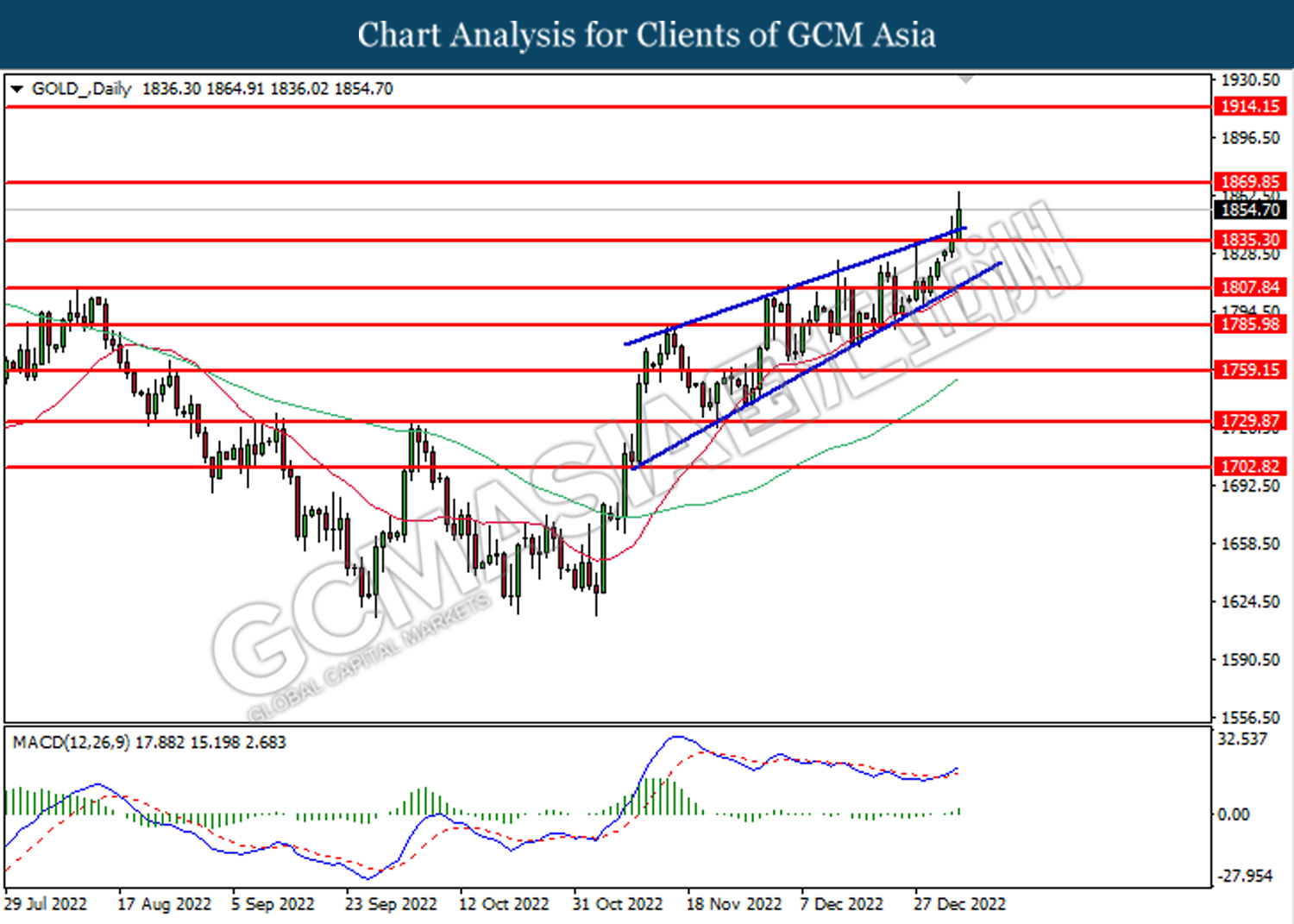

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1902.05, 1918.90

Support level: 1877.80, 1855.40

120123 Afternoon Session Analysis

12 January 2023 Afternoon Session Analysis

Japanese Yen surged ahead of policy review next week.

The Japanese Yen, which was widely traded by the investors around the world, jumped on expectation that the Bank of Japan (BoJ) may review the monetary policy in the next meeting. According to the latest news from Yomiuri, the BoJ is expected to review the side effects of its massive monetary easing in the upcoming meeting despite the last month’s modification of bond yield controls strategy. In the prior month, the BoJ has tried to stabilize the bond market by widening the band of long-term bond yield target from the previous cap of 0.25% to 0.50%. However, it failed to address the distortion in the bond market, and on the contrary, it heightened the speculation activity. Therefore, it urged the BoJ members to take a step back and review on its current monetary policy. A major policy tweak would likely to be seen in the upcoming meeting if it is necessary. As of writing, the pair of USD/JPY plummeted by -0.68% to 131.60.

In the commodities market, the crude oil price edged down by -0.36% to $77.50 per barrel after jumping significantly yesterday as the EU’s sanctions against the petroleum products from Russia overshadowed the effect of stockpiles in the US over the past week. Besides, the gold prices rose by 0.44% to $1883.85 per troy ounce as the majority of the investors are expecting the US CPI data would come in at a weaker pace.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Dec) | 0.20% | 0.30% | – |

| 21:30 | USD – CPI (YoY) (Dec) | 7.10% | 6.50% | – |

| 21:30 | USD – Initial Jobless Claims | 204K | 220K | – |

Technical Analysis

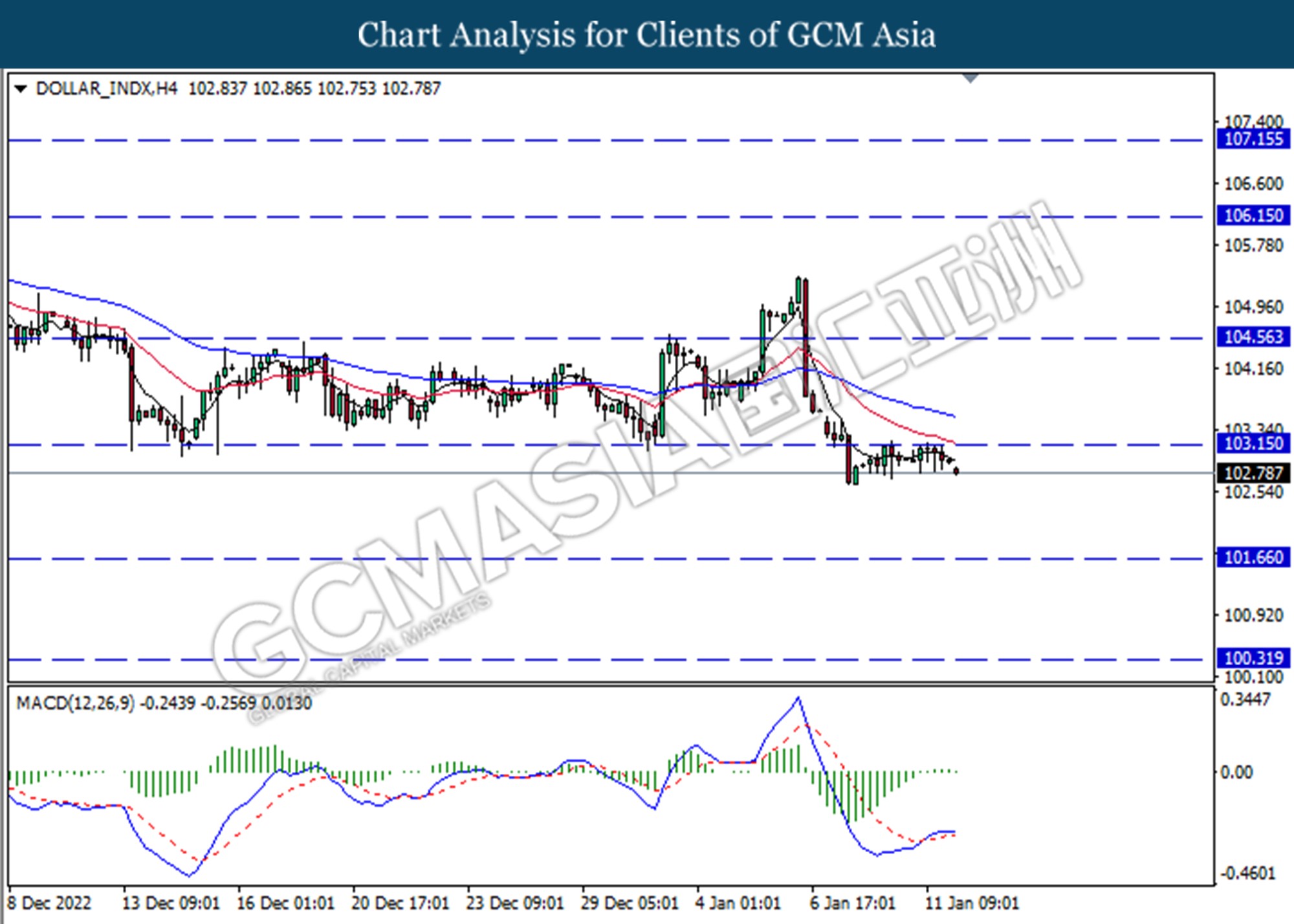

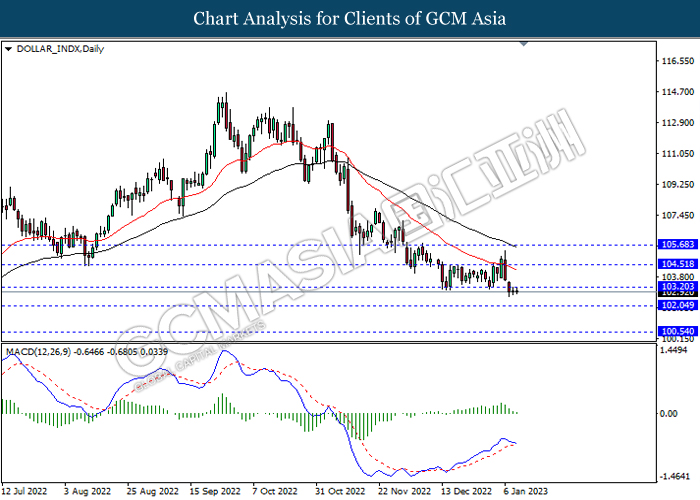

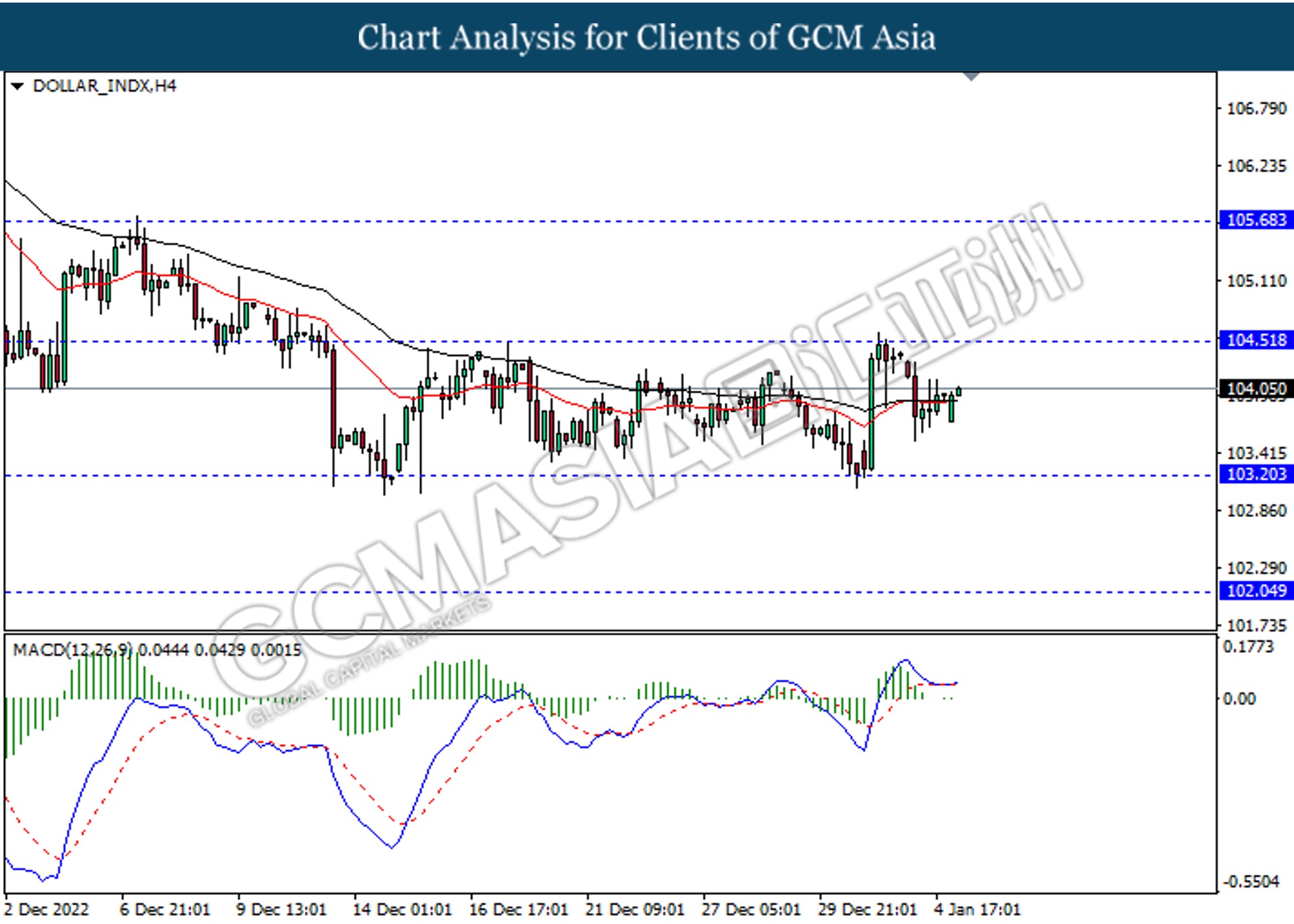

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breakout below the previous support level at 103.15. MACD which illustrated decreasing in bullish momentum suggest the index to extend its losses toward support level at 101.65.

Resistance level: 103.15,104.55

Support level: 101.65, 100.30

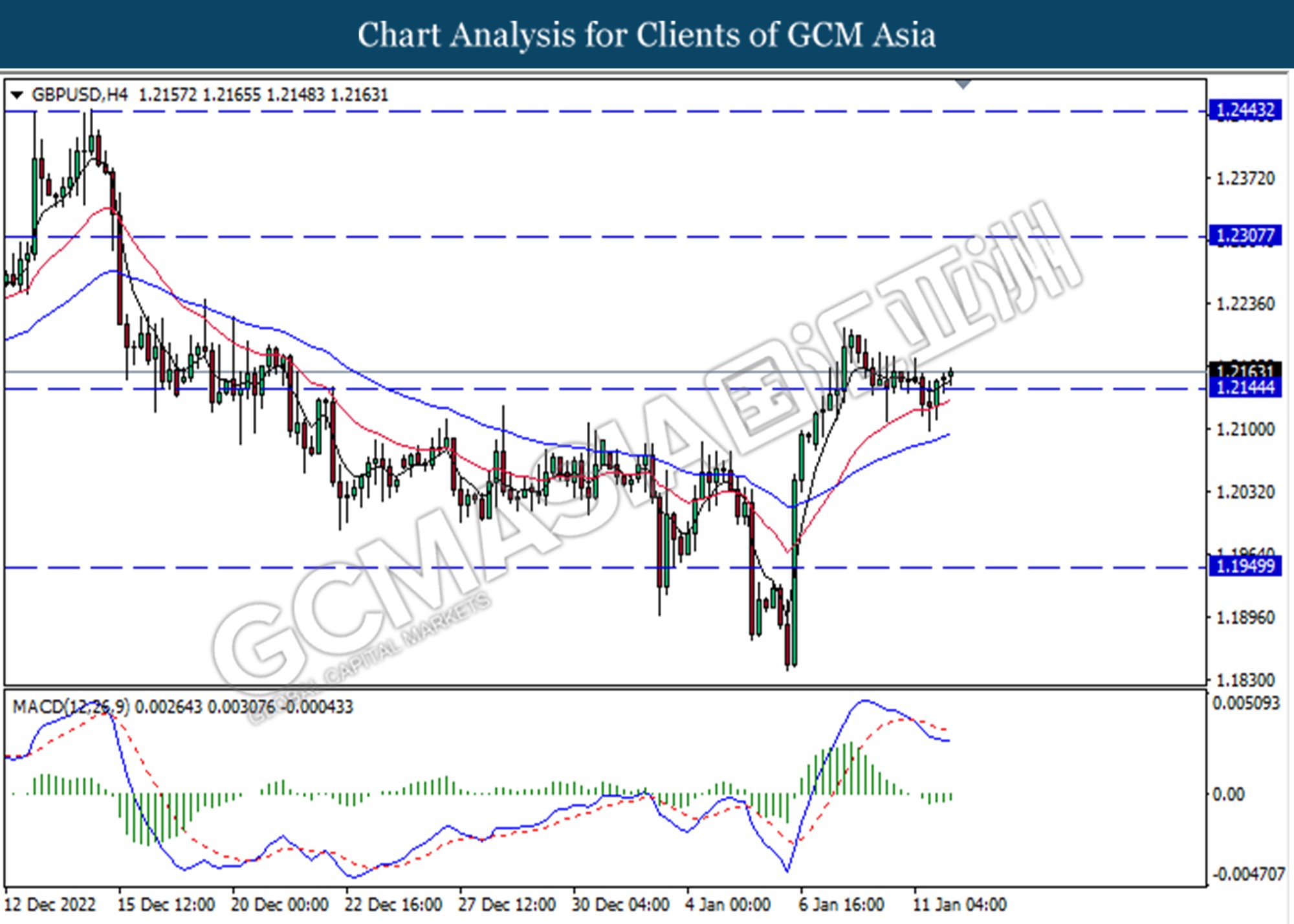

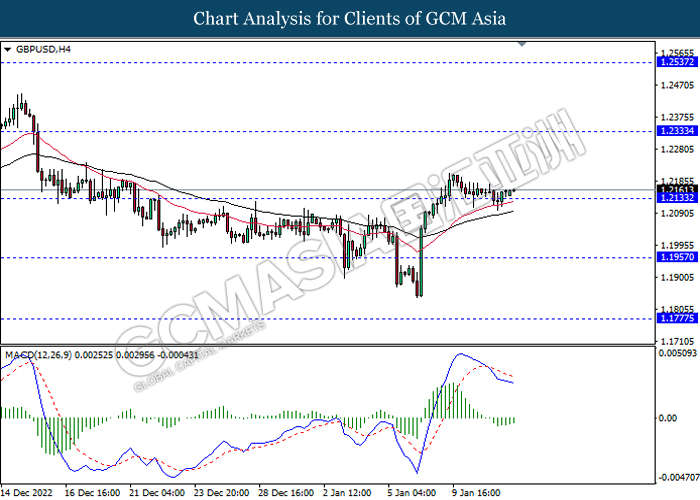

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2145. MACD which illustrated decreasing bearish momentum suggest the pair extend its gains toward the resistance level at 1.2310.

Resistance level: 1.2310, 1.2445

Support level: 1.2145, 1.1950

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0740. However, MACD which illustrated decreasing in bullish momentum suggest the pair undergo technical correction.

Resistance level: 1.0890, 1.0425

Support level: 1.0740, 1.0580

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 132.95. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses toward the support level 130.25.

Resistance level: 132.95, 134.50

Support level: 130.25,128.00

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6890. MACD which illustrated decreasing bearish momentum suggest the pair extend its gains toward the resistance level at 0.6960.

Resistance level: 0.6960, 0.7020

Support level: 0.6890, 0.6835

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6325. MACD which illustrated decreasing bearish momentum suggest the pair extend its gains toward the resistance level at 0.6450.

Resistance level: 0.6450, 0.6560

Support level: 0.6325, 0.6200

USDCAD,H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3475. However, MACD which illustrated bullish bias momentum suggest the pair undergo technical correction in short term.

Resistance level: 1.3475, 1.3705

Support level: 1.3230, 1.3035

USDCHF, H4: USDCHF was traded higher currently testing for resistance level at 0.9320. MACD which illustrated increasing in bullish momentum suggest the pair extend its gains after it successfully breakthrough the resistance level at 0.9320.

Resistance level: 0.9320, 0.9400

Support level: 0.9240, 0.9200

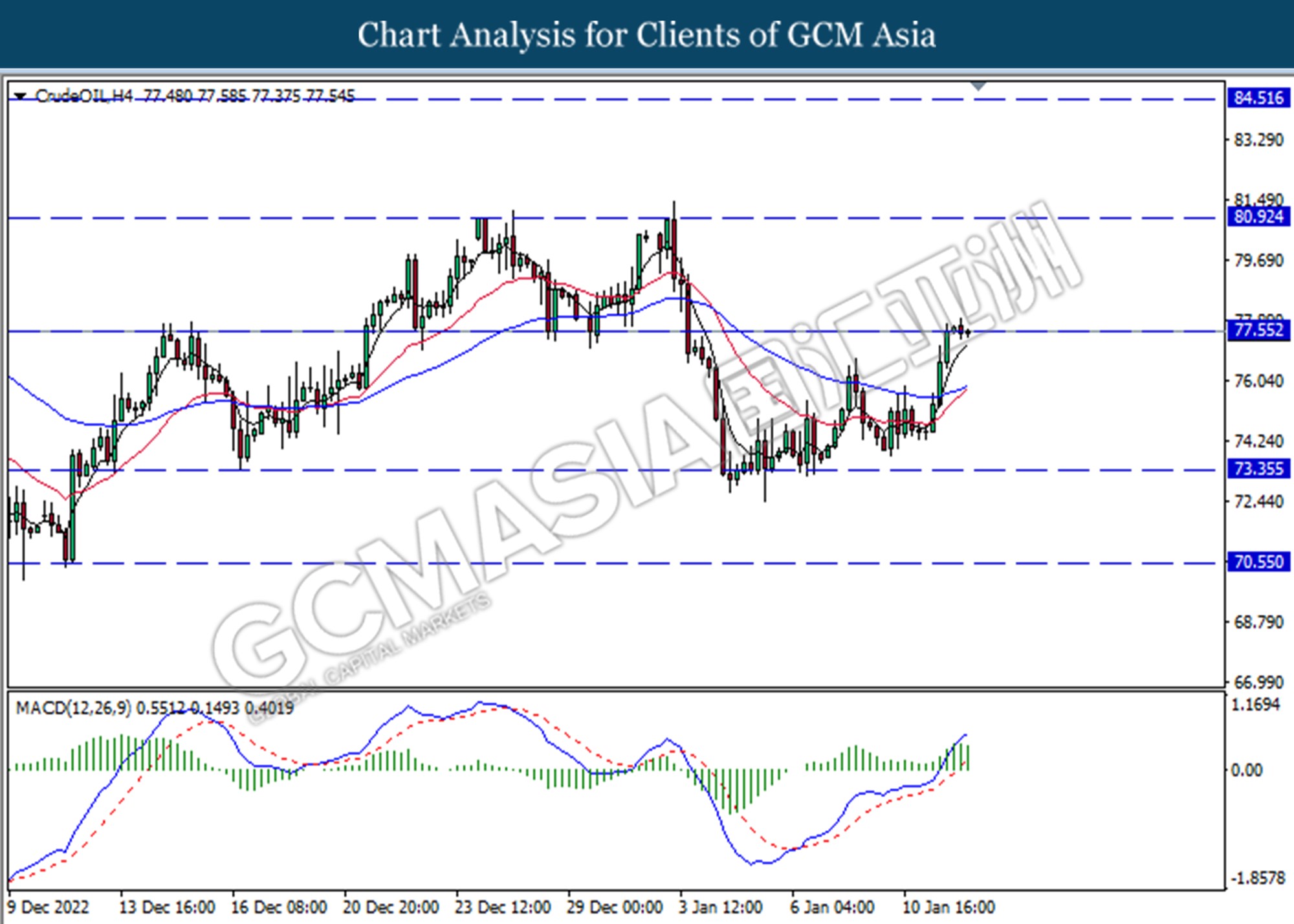

CrudeOIL, H4: Crude oil was traded higher currently testing for the resistance level at 77.55. MACD which illustrated increasing in bullish momentum suggest the commodity extend its gains if successfully breakthrough the resistance level at 77.55.

Resistance level: 77.55, 80.90

Support level: 73.35, 70.55

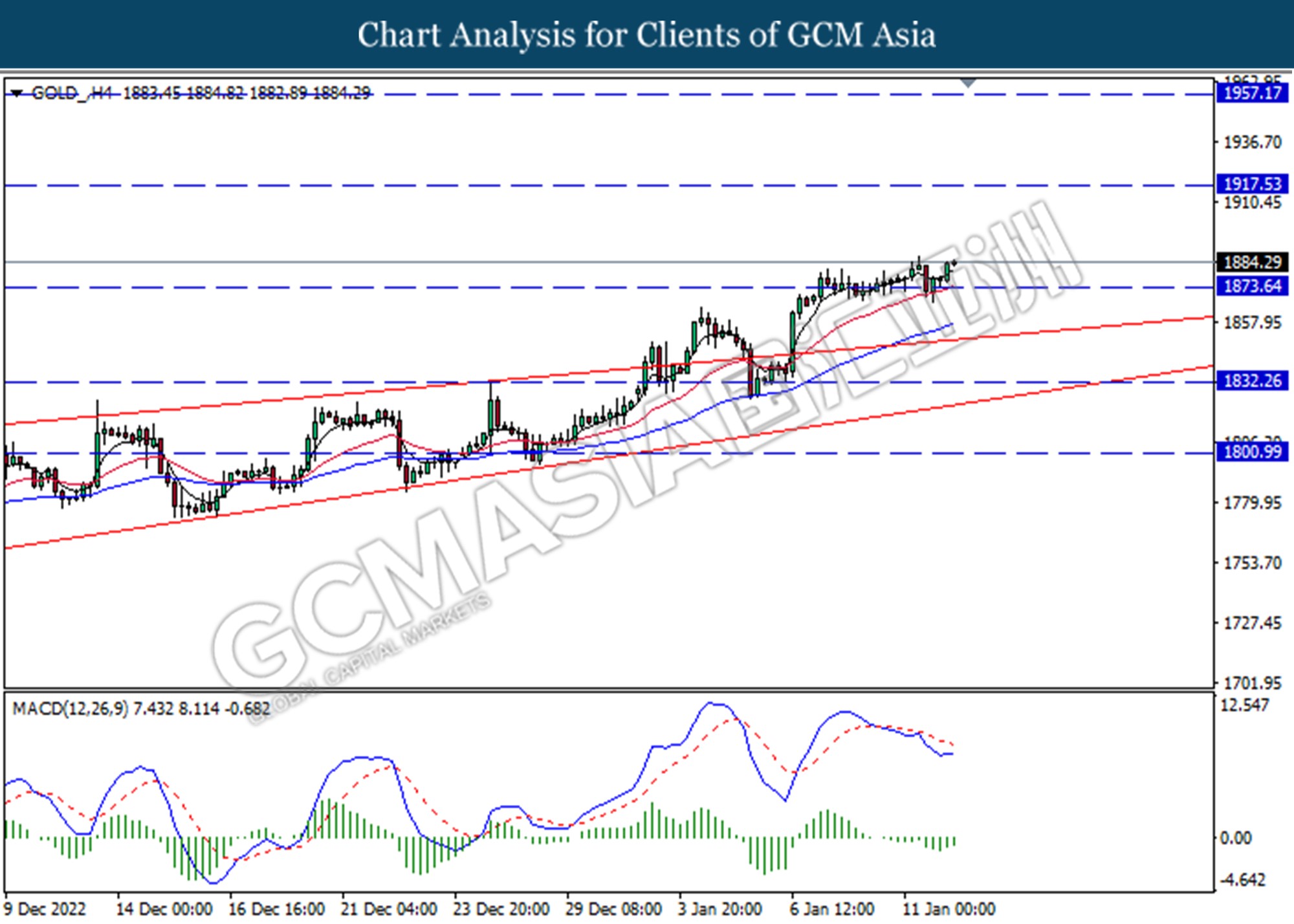

GOLD_, H4: Gold was traded higher following prior breakout above the previous resistance level at 1873.65. MACD which illustrated decreasing in bearish momentum suggest the commodity extend its gains.

Resistance level: 1917.55, 1957.20

Support level: 1873.65, 1832.25

120123 Morning Session Analysis

12 January 2023 Morning Session Analysis

US Dollar’s bear continues ahead of CPI data.

The Dollar Index which traded against a basket of six major currencies seesawed near its 7-month lows as the market participants still awaiting for the announcement of US inflation report. At this juncture, the US Consumer Price Index (CPI) YoY was widely expected to drop from the previous reading, and the economist speculation has given a 6.5%, lower than the prior of 7.1%. On the other hand, the dovish speech from Fed member was putting further pressure on the US Dollar. According to The New York Time, Susan M. Collins, the president of the Federal Reserve Bank of Boston claimed on Wednesday that she was inclined toward 25 basis point hikes in the February meeting. She deemed that smaller hike of interest rate would likely to provide more spaces for them to access the incoming data before decision-making. Nonetheless, she also reiterated that it was data-dependent over the rate hike decision. Thus, on-the-horizon CPI data would likely to have a significant impact on the future direction of the FX market. As of writing, the Dollar Index edged down by 0.01% to 102.98.

In the commodity market, the crude oil price depreciated by 0.05% to $77.70 per barrel as of writing following the rising of oil inventories. According to EIA, the US Crude Oil Inventories increased by 18.962M barrels, exceeding the market expectation. In addition, the gold price appreciated by 0.03% to $1875.81 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Dec) | 0.20% | 0.30% | – |

| 21:30 | USD – CPI (MoM) (Dec) | 0.10% | 0.10% | – |

| 21:30 | USD – CPI (YoY) (Dec) | 7.10% | 6.50% | – |

| 21:30 | USD – Initial Jobless Claims | 204K | 220K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.20, 104.50

Support level: 102.05, 100.55

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0890, 1.1040

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher ad technical correction.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00

110123 Afternoon Session Analysis

11 January 2023 Afternoon Session Analysis

Upbeat Retail Sales gave a booster to Aussie dollar.

The Australian dollar, which is broadly known as the Aussie dollar, jumped following the release of the Retail Sales data early today. According to the Australian Bureau of Statistics, the Australia Retail Sales data came in at 1.4%, significantly higher than the previous month reading’s 0.4% and the consensus forecast at 0.6%. The stronger-than-expected retail sales data indicated the overall consumer spending in the month of November 2022 grew amid the Black Friday shopping event. With such a backdrop, it raised the market expectation that the Reserve Bank Australia (RBA) would likely to keep the interest rate at high level to avoid the risk of sky-high inflationary pressure happens again. Besides, as mentioned in the prior article, the optimism of China’s reopening continued to spark some bullish momentum in the Aussie dollar market as China plays an important role in Australia’s trading activity. As of writing, the pair of AUD/USD rose 0.09% to 0.6895.

In the commodities market, the crude oil price edged down by -0.24% to $74.55 per barrel after API showed crude oil stockpiles in the US. Besides, the gold prices depreciated by -0.06% to $1876.00 per troy ounce while the market participants are waiting for the CPI data tomorrow.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.694M | -2.243M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0775. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3400. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following prior breakout below the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

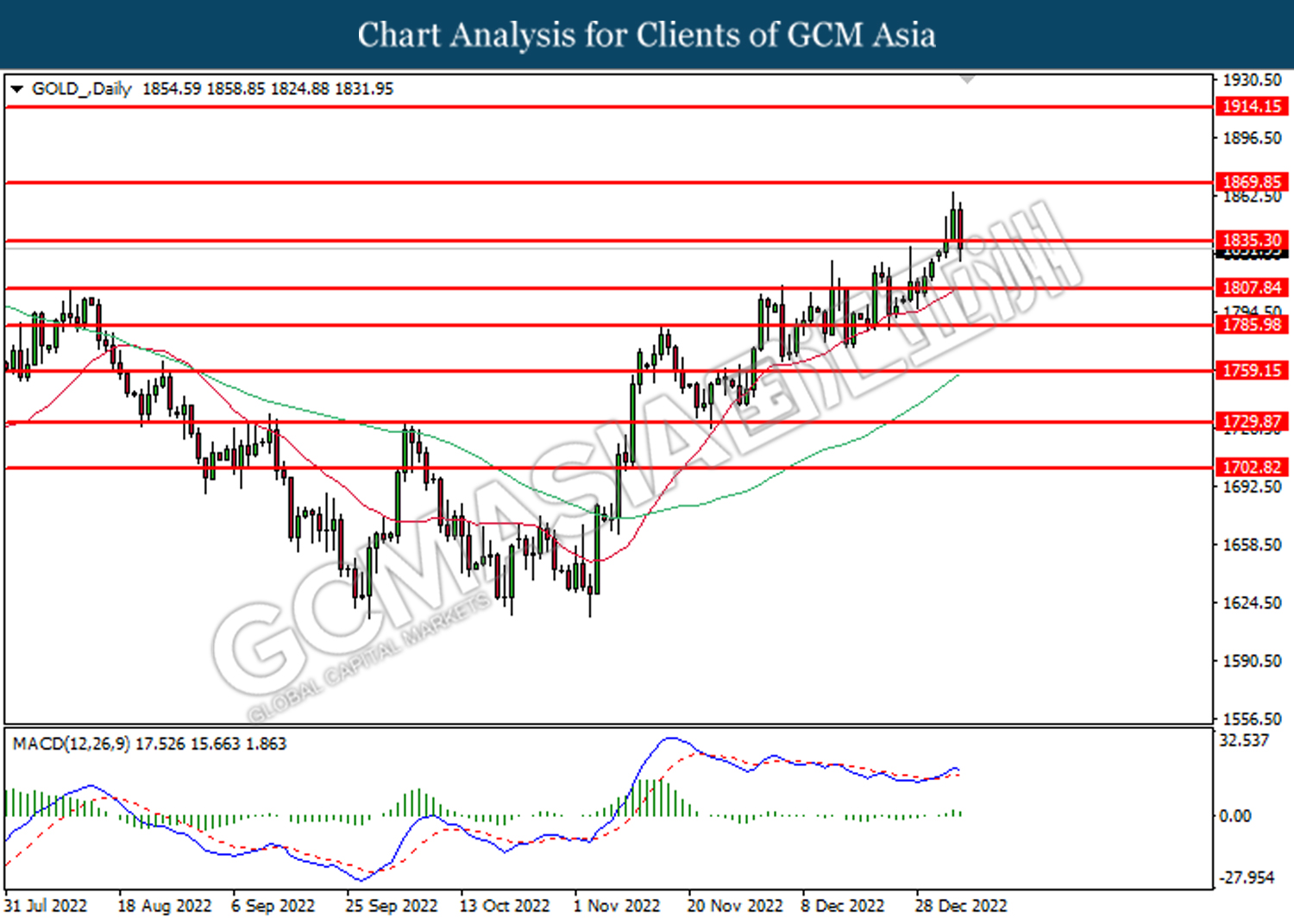

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1869.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1914.15.

Resistance level: 1914.15, 1957.85

Support level: 1869.85, 1825.50

110123 Morning Session Analysis

11 January 2023 Morning Session Analysis

Greenback recorded gains as Fed hinted for further rate hikes.

The Dollar Index which gauge its value with the six major currencies rose significantly on yesterday after the Fed Chairman released its speech. According to CNBC, Fed Chairman Jerome Powell had reiterated the significance of rate hikes in the current time basis, even the step taken by Fed would likely to be unpopular. In the speech, Jerome Powell claimed that the central bank was raising interest rate in order to slow down the economy. However, he emphasized that price stability was the footstone of a healthy economy and provides the citizens with immeasurable benefits over time. The remarks echoed those from other Fed members, including San Francisco Fed President Mary Daly and Atlanta Fed President Raphael Bostic, who endorsed the Fed to keep its cash rates higher for longer time. Though, with investors still skeptical about the Fed’s rate hikes plan as well as the investors are highly eyeing on-the-horizon CPI data in Thursday, the gains experienced by US Dollar was limited. As of writing, the Dollar Index raised by 0.28% to 103.02

In the commodity market, the crude oil price depreciated by 0.27% to $74.50 per barrel as of writing following the rising of crude oil inventories. According to API, the US API Weekly Crude Oil Stock increased by 14.865M barrels, far higher than the consensus speculation. On the other hand, the gold price dropped by 0.01% to $1876.76 per troy ounce as of writing over the slightly rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.694M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.20, 104.50

Support level: 102.05, 100.55

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successful breakout the resistance level.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher ad technical correction.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00

100123 Afternoon Session Analysis

10 January 2023 Afternoon Session Analysis

Aussie dollar surged amid the market optimism of China reopening.

The Australian dollar, which is broadly known as the Aussie dollar, was boosted by the heightening of market demand for riskier assets following the reopening of China. On 8th January 2023, China finally reopened its border for international travelers for the first time since the outbreak of Covid-19 in March 2020. In detail, the incoming travelers are no longer required to undergo the quarantine process, but proof of a negative PCR test needs to be shown within 48 hours of traveling. With that, the China economy is expected to recover strongly in the year of Rabbit, although the high Covid-19 cases still overshadow the nation. As China is Australia’s largest trading partner in terms of imports and exports, the country’s recovery prospect is expected to boost Australia’s economic activity concurrently. Alongside, as the rate hike cycle is getting closer to the end of the cycle, the appeal of the dollar index faded while urging the investors to sell off their Greenback holdings.

In the commodities market, the crude oil price dropped by -0.91% to $74.35 per barrel as global recession risk overshadowed the oil market outlook. Besides, the gold prices rose 0.11% to $1873.70 per troy ounce as the dollar index extended its losses in the previous trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0775. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3400.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following prior breakout below the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1869.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1869.85, 1914.15

Support level: 1825.50, 1807.85

100123 Morning Session Analysis

10 January 2023 Morning Session Analysis

US Dollar weakened amid lower rate hike background.

The Dollar Index which traded against a basket of six major currencies dropped to its 7-month low over the investors bet on a lower rate increased by Fed. According to Reuters, market participants belief that Fed would less likely to raise its interest rate more than 5% in the February meeting, as the inflation and economy in the US shown a sign of downturn while the Fed’s rate hike did have some notable effects on it. Based on the CME FedWatch Tool, the likelihood of 25 basis point rate hike was reached 79.2%, as well as the possibility of half-of-a-percentage hike was only about 20.8%. However, it is noteworthy that the interest rate would likely to be higher for a long period in order to curb inflation which still far from Fed’s 2% target, according to the speech of Fed Chairman Jerome Powell. As of now, investors would highly eye on the speech of Fed Chairman Jerome Powell that scheduled tonight as it can provide a clearer views on its rate hikes path. As of writing, the Dollar Index depreciated by 0.69% to 102.93.

In the commodities market, the crude oil price dropped by 0.20% to $74.75 per barrel as of writing as the concern against global recession still disturbing market sentiment toward oil demand. On the other hand, the gold price edged down by 0.06% to $1870.76 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.20, 104.50

Support level: 102.05, 100.55

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from a higher price level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity extend its losses.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00

090123 Afternoon Session Analysis

09 January 2023 Afternoon Session Analysis

Canadian dollar jumped amid positive labor data.

The Canadian dollar, which was majorly traded by the global investors, skyrocketed following the release of an upbeat job data. According to the Statistics Canada, Canada Employment Change jumped from the prior month reading’s 10.1K to 104.0K, mirroring the high resiliency of the nation’s labor market. With the backdrop of hot labor data, it provided Bank of Canada (BoC) with much more spaces for rate hike move in the coming meeting. In order to curb the sky-high inflation, the BoC has been raising the interest rate aggressively since Jan 2022. The cash rates have been adjusted upward from the low level at 0.25% to 4.25% as of the meeting in December 2022. On the other sides, the currency pair of USD/CAD plummeted further after US services sector showed contraction in the month of December. According to the PMI, US Services PMI came in at 49.6, missing the consensus forecast at 55.0. It is noteworthy to highlight that the services sector accounted for two third of the overall US economic activities. As of writing, the pair of USD/CAD plunged -0.23% to 1.3410.

In the commodities market, the crude oil price rose by 0.43% to $74.55 per barrel as the weakening of dollar index reduced the cost of oil for the non-US buyers. Besides, the gold prices rose 0.60% to $1877.50 per troy ounce after the US released a weaker-than-expected services PMI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0675, 1.0775

Support level: 1.0575, 1.0475

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3400.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following prior breakout below the support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1869.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1869.85, 1914.15

Support level: 1825.50, 1807.85

090123 Morning Session Analysis

9 January 2023 Morning Session Analysis

Greenback plunged with mixed economic data.

The Dollar Index which traded against a basket of six major currencies slumped on Friday night despite a series of upbeat employment data. According to Bureau of Labor Statistics, the US Nonfarm Payrolls in December posted at the reading of 223K, exceeding the consensus forecast of 200K. Besides, the unemployment rate in December was reduced for the second month in a row. Nonetheless, if it went into details, the figures of NFP data was notched down from the prior, which indicating the job opportunity was easing. On the other hand, the weakened of wage growth had also put some sell-off pressure on US Dollar. The US Average Hourly Earnings YoY for December notched down from the previous reading of 4.8% to 4.6%, missing the market expectation of 5.0%. With that, it indirectly shown the easing economy momentum in the US, which diminishing worries about Fed’s interest rate hiking path. Furthermore, the US ISM Non-Manufacturing data had given a weaker-than-expected figures, which spurred further bearish momentum toward US Dollar. As of writing, the Dollar Index edged down by 0.08% to 103.56.

In the commodities market, the crude oil price rose by 0.50% to $74.10 per barrel as of writing following the weaker dollar had boosted demand for oil as dollar-denominated commodities become cheaper for holder of other countries. On the other hand, the gold price appreciated by 0.07% to $1869.55 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day JPY Japan – Respect for the Aged Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.70

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses of successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity extend its gains.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00

060123 Afternoon Session Analysis

6 January 2023 Afternoon Session Analysis

Pound Sterling dipped as UK economic still hovered in recession.

The GBP/USD, which traded widely by global investors slumped throughout yesterday trading session over the bearish economic data. According to Markit Economics, the UK Composite Purchasing Managers’ Index (PMI) in December notched up from the previous reading of 48.2 to 49.0, which met with the market expectation. Besides, the UK Services Purchasing Managers Index (PMI) had also rose slight in December. Though, these two data has posted at the reading that below 50, which indicating that the UK economic sector were still under contraction. With that, it stoked a shift in sentiment toward other currencies such as US Dollar. On the other hand, the China-proxy currency, AUD/USD dropped significantly following the slowing economy activities which driven by rising Covid infection. According to CNBC Supply Chain Heat Map data, China manufacturing orders down by 40%, with 1/2 or even 3/4 of the labor force being infected and not able to work. The current situation might be continued till 2nd half of January and early February. As of writing, the GBP/USD appreciated by 0.23% to 1.1933 while AUD/USD up by 0.40% to 0.6776.

In the commodities market, the crude oil price rose by 1.24% to $74.60 per barrel as of writing following the reopening in the China-Hong Kong border spelt some demand for this black commodity. In addition, the gold price edged up by 0.19% to $1839.18 per troy ounce as of writing over the weakened US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Dec) | 0.718M | -1.520M | – |

| 18:00 | EUR – CPI (YoY) (Dec) | 50.4 | – | – |

| 21:30 | USD – Nonfarm Payrolls (Dec) | 10.1% | 9.7% | – |

| 21:30 | USD – Unemployment Rate (Dec) | 263K | 200K | – |

| 21:30 | CAD – Employment Change (Dec) | 3.7% | 3.7% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Dec) | 10.1K | 7.5 | – |

| 23:00 | CAD – Ivey PMI (Dec) | 56.5 | 55.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.70, 106.90

Support level: 104.50, 103.20

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1955, 1.2135

Support level: 1.1775, 1.1635

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6150, 0.6035

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55

060123 Morning Session Analysis

6 January 2023 Morning Session Analysis

Greenback surged amid upbeat jobs data.

The dollar index, which traded against a basket of mainstream currencies, extended its rally during the past trading session amid the US released a series of strong labor data. Yesterday, the ADP private payrolls report for the last month of 2022 showed that the number of jobs has been increased to 234K, beating the consensus forecast at 150K, signaling that the US labor market remains hot and resilient. On top of that, the Department of Labor also reported the Initial Jobless Claims data with a lower-than-expected reading, which triggered further bullish momentum in the US dollar market. According to the report, the number of American who filed for unemployment benefit came in at 204K, missing the economist forecast at 225K, refreshing the record of lowest number of claims in 14 weeks. Besides, St. Louis Federal Reserve President James Bullard presented his view on the outlook of year 2023 earlier today. In the speech, he revealed that the year 2023 may be a disinflationary year, but the policy is not sufficiently restrictive yet. With the backdrop of hot labor market and hawkish bias statement from Fed Bullard, investors exited from the riskier asset and rushed into the dollar market. As of writing, the US dollar rose by 0.84% to 105.15.

In the commodities market, crude oil prices rose by 1.02% to $74.00 per barrel after the US government reported unexpectedly high demand for diesel during the end of 2022. Besides, gold prices edged down by -1.15% to $1833.50 per troy ounce after the US labor market reported upbeat data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Dec) | 0.718M | -1.520M | – |

| 18:00 | EUR – CPI (YoY) (Dec) | 50.4 | – | – |

| 21:30 | USD – Nonfarm Payrolls (Dec) | 10.1% | 9.7% | – |

| 21:30 | USD – Unemployment Rate (Dec) | 263K | 200K | – |

| 21:30 | CAD – Employment Change (Dec) | 3.7% | 3.7% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Dec) | 10.1K | 7.5 | – |

| 23:00 | CAD – Ivey PMI (Dec) | 56.5 | 55.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1940. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0675, 1.0775

Support level: 1.0575, 1.0475

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.15. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6730. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1835.30. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1869.85, 1914.15

Support level: 1835.30, 1807.85

050123 Afternoon Session Analysis

5 January 2023 Afternoon Session Analysis

Aussie dived as China Covid infections might be under-reported.

The AUD/USD, one of the China-proxy currency plunged on yesterday over the rising concerns on surging Covid-19 cases in China. According to Reuters, World Health Organization (WHO) officials claimed on Wednesday that the infection of Covid-19 in China would likely to be under-represented. China reported five new COVID deaths for Tuesday, bringing the official death toll to 5,258, very low by global standards. In fact, the data from China has reported that filled hospitals and overwhelmed some funeral house when China government decided to ease its ‘zero-Covid’ restriction. It has led to growing global unease about the accuracy of China’s reporting of the Covid data while giving the hints which the lockdowns might be executed again. With such background, the market optimism toward China economic progression would likely to be dragged down, as well as the Australia might suffer from the economy downturn since China was the major trading partner with Australia. As of writing, the AUDUSD depreciated by 0.25% to 0.6815.

In the commodities market, the crude oil price rose by 1.07% to $73.62 per barrel as of writing after the sharp decline throughout overnight trading session following the rising of API crude oil stock. On the other hand, the gold price appreciated by 0.10% to $1854.90 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Dec) | 48.2 | 48.2 | – |

| 17:30 | GBP – Services PMI (Dec) | 48.8 | 48.8 | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Dec) | 127K | 127K | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.70

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains. If successfully breakout the resistance level.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 73.90, 77.25

Support level: 70.60, 67.60

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55

050123 Morning Session Analysis

5 January 2023 Morning Session Analysis

Dollar jumped amid hawkish Fed minutes and hot labor data.

The dollar index, which traded against a basket of mainstream currencies, managed to hold its ground following the release of the hawkish Fed minutes. In the early morning, the Greenback received some bullish momentum as the Fed minutes showed that the officials are still committed to cooldown the overheating economy by raising the interest rate higher for a period of time ahead. Additionally, the Fed policymakers also reiterated that a restrictive monetary policy would not be unfold and need to be remained for a certain time until data showed that the inflation was on a right path to their 2% long-term target. In the meeting, the Fed’s board of members agreed to increase the official cash rate by 50 basis point to the range between 4.25 – 4.5%. The intention of maintaining the restrictive monetary policy is to avoid the risk of easing too soon, which might cause the inflation to run rampantly. Prior to the release of the Fed meeting minutes, the dollar index gotten a boost from a hot labor data. According to the Bureau of Labor Statistics, the US JOLTs Job Openings came in at 10.458M, beating the consensus forecast at 10.000M, mirroring that the US labor market remain resilient while signaling that the upcoming crucial labor data such as NFP will have an upbeat result. As of writing, the dollar index edged down by -0.28% to 104.22.

In the commodities market, crude oil prices rose by 0.27% to $73.45 per barrel after falling substantially during the previous trading session amid market concerns about global demand toward the oil market with the background of soaring Covid-19 cases in China and heightening of global recession risk. Besides, gold prices edged up by 0.02% to $1854.55 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Dec) | 48.2 | 48.2 | – |

| 17:30 | GBP – Services PMI (Dec) | 48.8 | 48.8 | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Dec) | 127K | 127K | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded higher following prior rebound near the support level at 1.0575. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0675, 1.0775

Support level: 1.0575, 1.0475

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from support level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3505. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9310. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 76.10. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1835.30. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1869.85.

Resistance level: 1869.85, 1914.15

Support level: 1835.30, 1807.85

040123 Afternoon Session Analysis

4 January 2023 Afternoon Session Analysis

Euro plunged amid easing inflationary risk.

The EUR/USD, which widely traded by global investors slumped over the easing inflation risk in Eurozone country. According to Federal Statistical Office Germany, the Germany Consumer Price Index (CPI) YoY for December has notched down from the previous reading of 10.0% to 8.6%, far lower than consensus forecast of 9.1%. In fact, the slips of Germany inflationary risk would likely to bring down the inflation in Eurozone that reached double-digit, whereas decreasing the odds of aggressive rate hikes from European Central Bank (ECB). Hence, investors could their eyes toward other currencies which providing better return. On the other hand, the GBP/USD has also recorded a losses on yesterday amid the background of economic recession. The UK Manufacturing Purchasing Managers Index (PMI) in December posted at the reading of 45.3, exceeding the market expectation of 44.7. Nonetheless, the figures that less than 50 indicated a contraction in the UK manufacturing sector, which brought negative prospects toward economic progression in the UK. As of writing, the EUR/USD rose by 0.21% to 1.0568 while GBP/USD appreciated by 0.18% to 1.1987.

In the commodities market, the crude oil price eased by 0.21% to $76.77 per barrel as of writing following the looming global recession which warned by International Monetary Fund (IMF). In addition, the gold price appreciated by 0.29% to $1845.50 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 USD FOMC Meeting Minutes

(5th Jan)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – ISM Manufacturing PMI (Dec) | 49.0 | 48.5 | – |

| 23:00 | USD – JOLTs Job Openings (Nov) | 10.334M | 10.000M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.70

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55

040123 Morning Session Analysis

4 January 2023 Morning Session Analysis

US dollar surged ahead of Fed meeting minutes.

The dollar index, which traded against a basket of mainstream currencies, managed to regain its luster in the previous trading session while the market participants were waiting for the Fed’s Meeting Minutes. The December FOMC Meeting Minutes are expected to shed some additional light on Fed officials’ policy view for 2023. It is noteworthy to highlight that the Fed’s members broadly agreed to go for a higher terminal rate this year, despite a slower pace of rate hikes. In the recent Fed meeting, the board of members delivered a 50-basis point of rate hikes after raising the interest rate for four consecutive 75 basis points. The slower rate hike was mainly attributed to the sign of inflation easing in the nation. Besides, the market risk-off mood turned on right after China’s manufacturing data showed a sharp drop in December amid the resurgence of Covid-19 cases, which had disrupted the production of the country after the lockdown measure was implemented. As of writing, the dollar index rose 1.11% to 104.65.

In the commodities market, crude oil prices depreciated by -0.26% to $77.10 per barrel as the China Caixin Manufacturing PMI data showed a sharp drop in December reading as compared to the prior months. Besides, gold prices edged down by -0.05% to $1838.60 per troy ounce as the IMF’s pessimistic forecast about global economic growth sparked the market risk-off mood.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 USD FOMC Meeting Minutes

(5th Jan)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – ISM Manufacturing PMI (Dec) | 49.0 | 48.5 | – |

| 23:00 | USD – JOLTs Job Openings (Nov) | 10.334M | 10.000M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 131.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6730. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 81.35. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1835.30. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00