030123 Afternoon Session Analysis

3 January 2023 Afternoon Session Analysis

Yen regained its luster as the monetary policy could be changed.

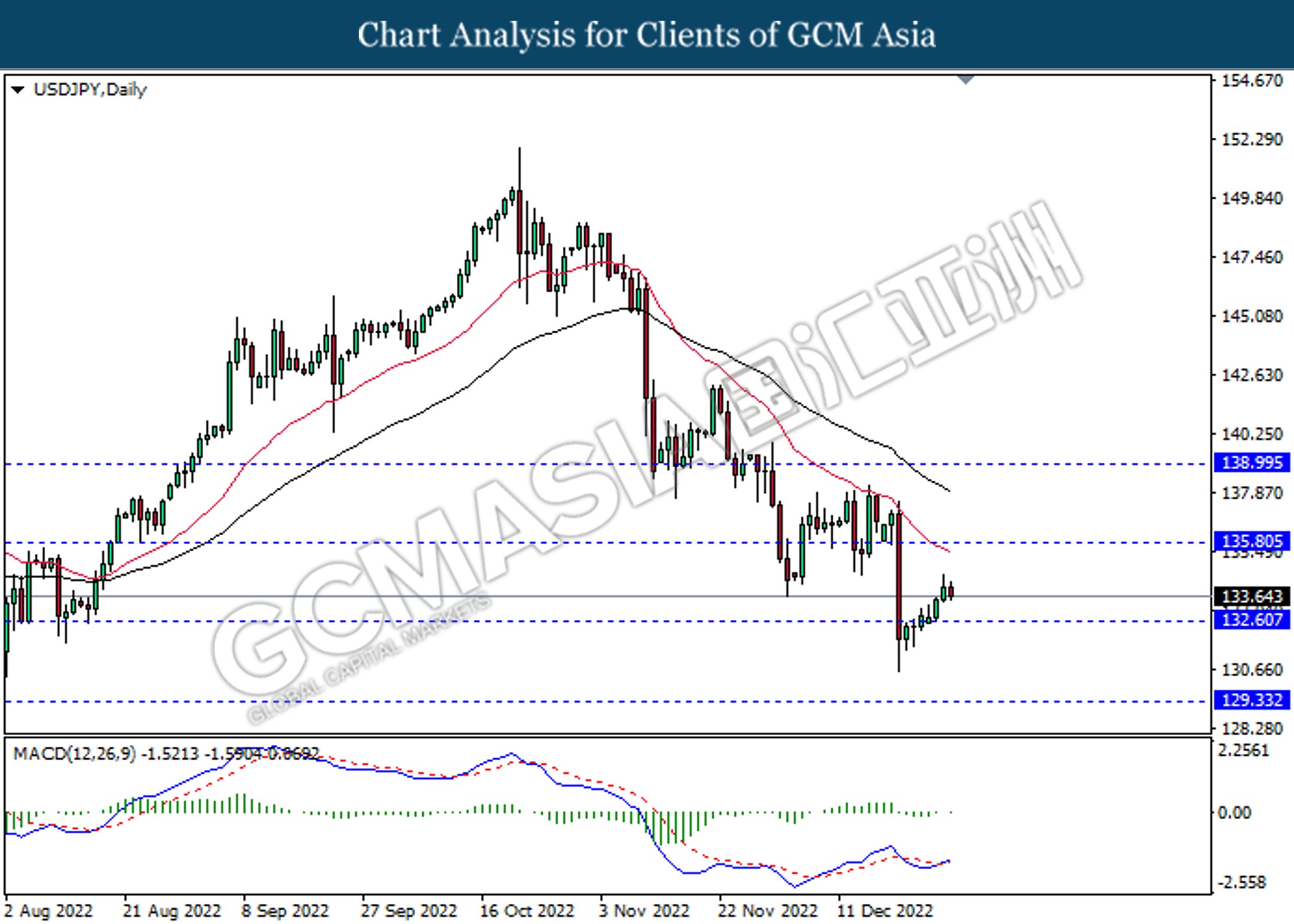

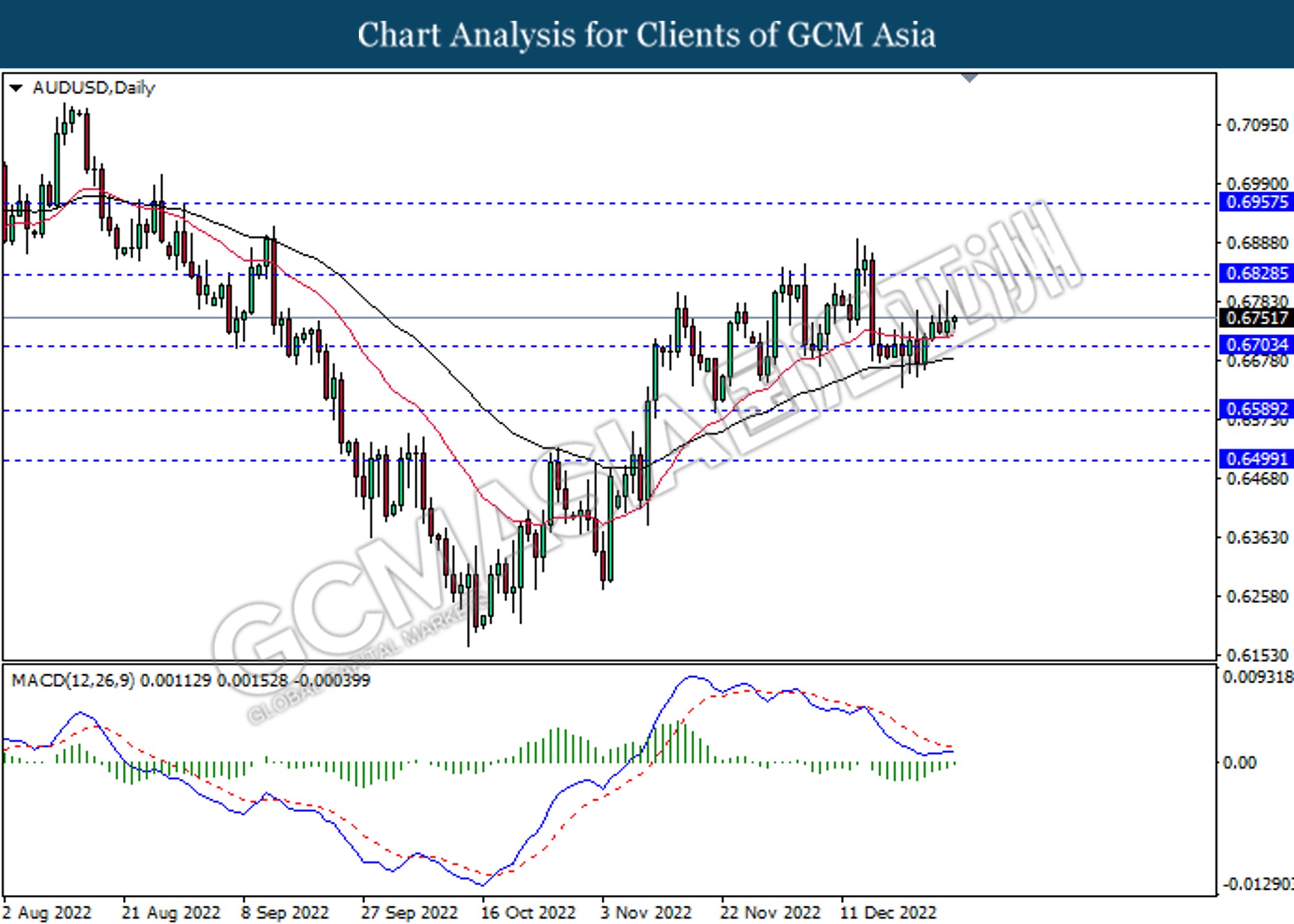

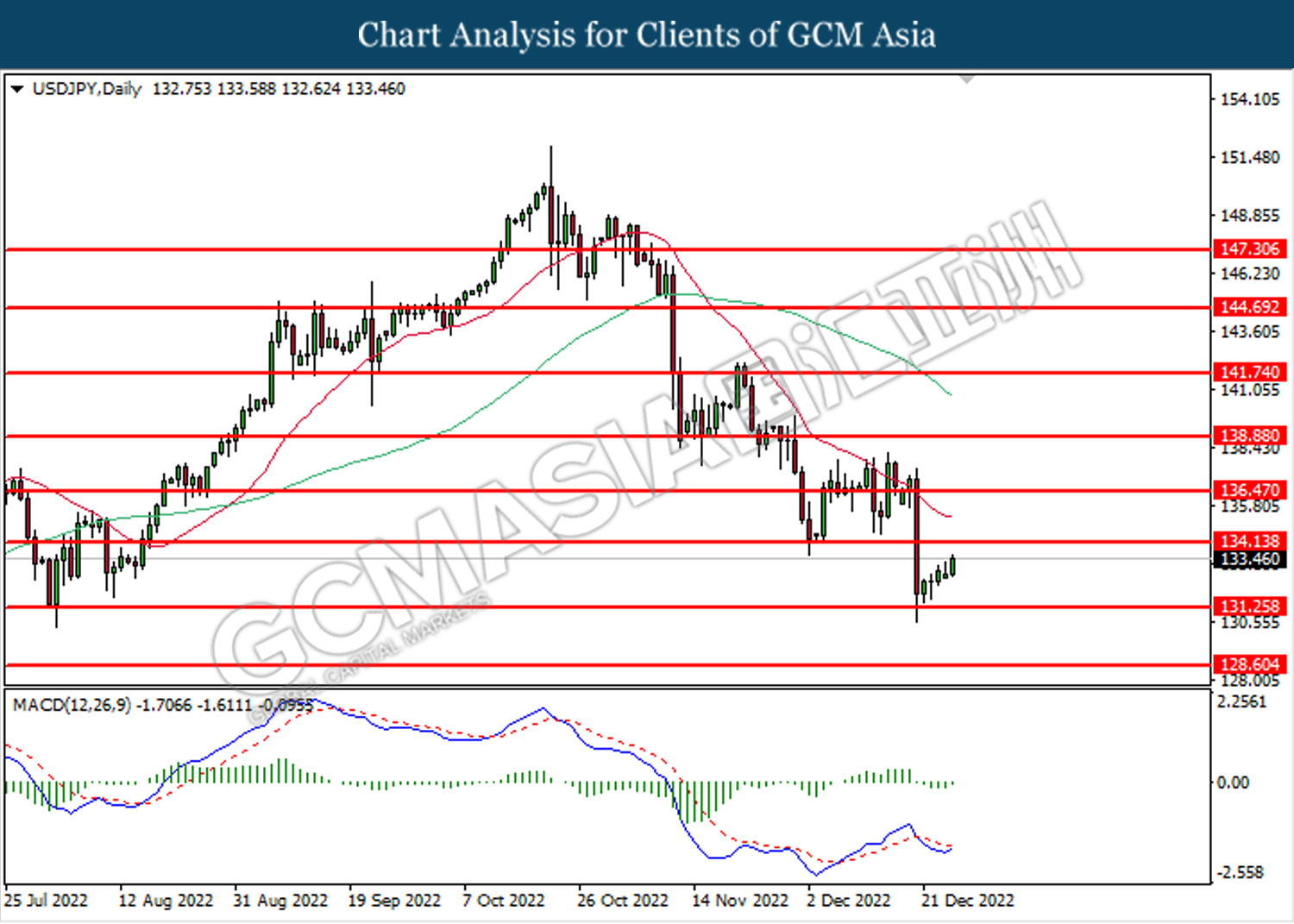

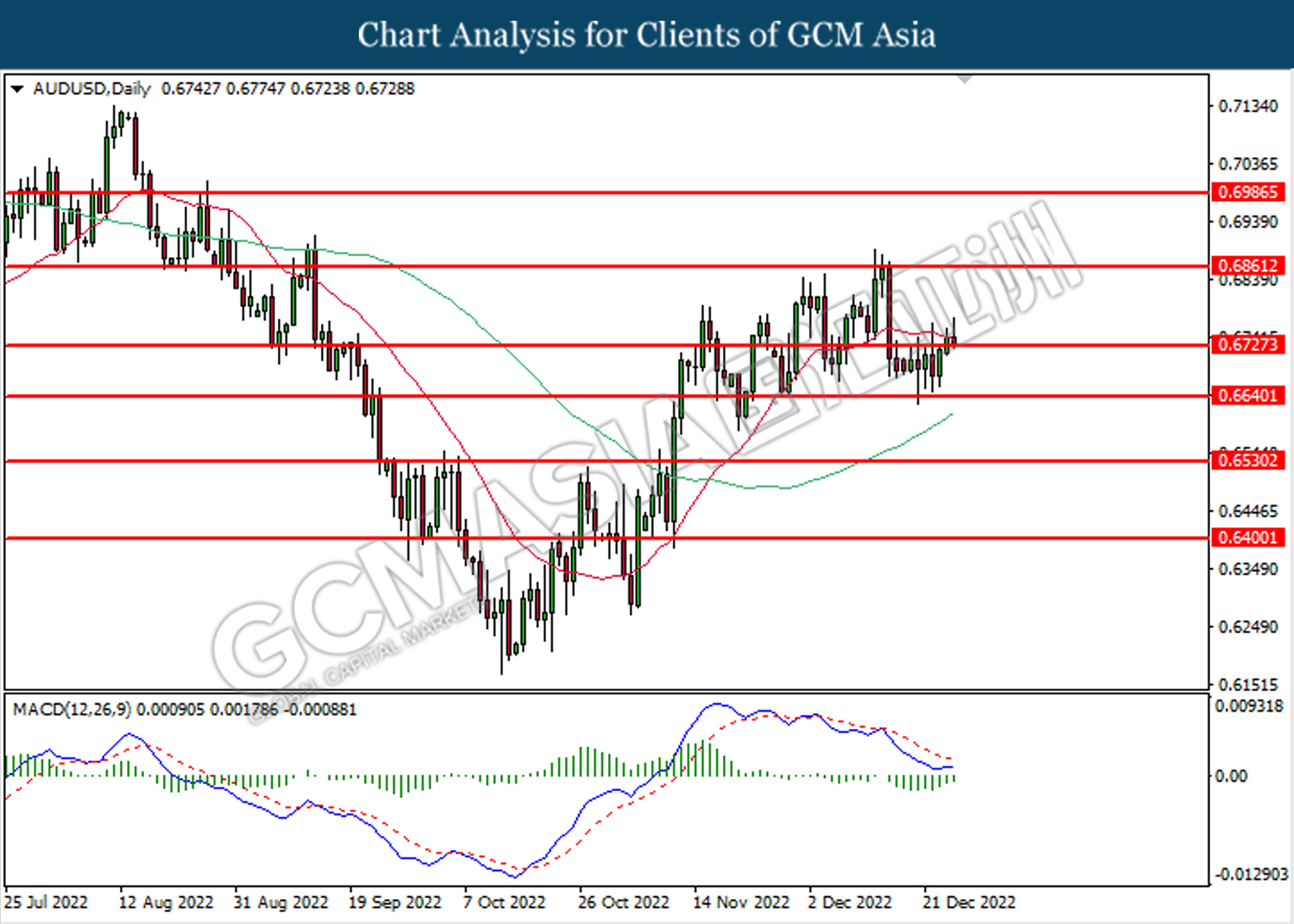

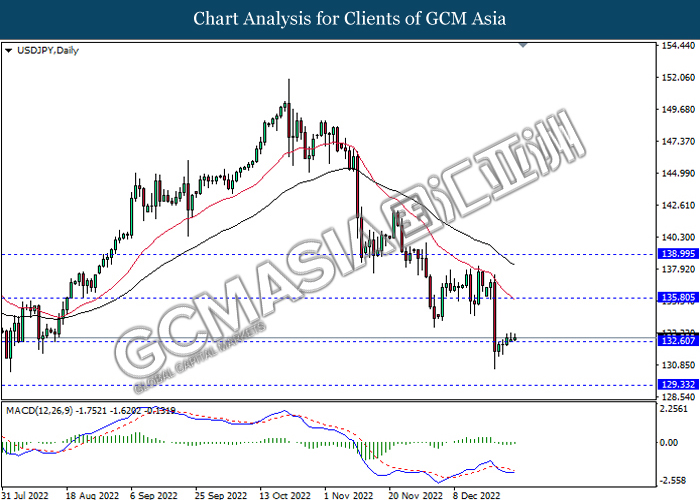

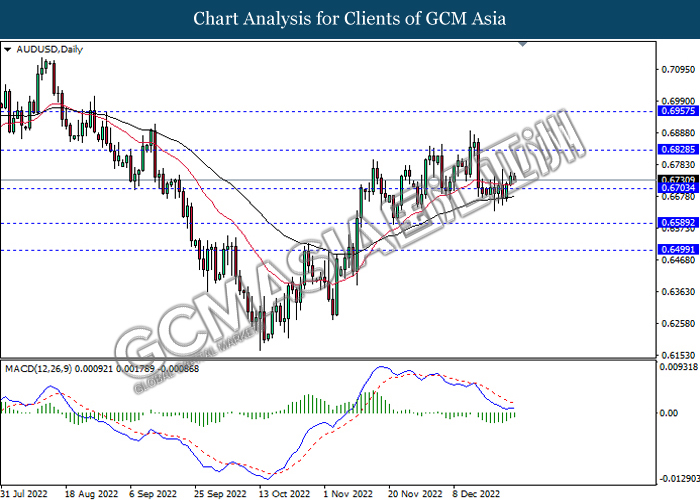

The USD/JPY, which widely traded by global investors slumped after the New Year holidays in many countries yesterday over the rising expectation of changing monetary policy of Bank of Japan (BoJ). In December, BoJ surprised market by increasing its yield curve band from 0.25% to 0.50%, which giving the hints that the BoJ could repeal its loosening monetary policy. Besides that, the current BoJ Governor Haruhiko Kuroda would put down his term in April, and the market participants anticipated that the BoJ would be planning to implement contractionary monetary policy after the new governor take over the seat. Though, Kuroda has claimed that he was not shy to remain the ultra-low interest rate until the end of his term. On the other hand, the AUD/USD rose significantly in the early trading session following the upbeat China economic data. According to Markit, China Caixin Manufacturing Purchasing Managers Index (PMI) for December came in at the reading of 49.0, exceeding the consensus forecast of 48.8. The Australia’s economy was benefited as China was the major trading partner for it. As of writing, the USD/JPY depreciated by 0.75% to 129.74 while AUD/USD had raised by 0.47% to 0.6834.

In the commodities market, the crude oil price eased by 0.22% to $80.08 per barrel as of writing as the warning on economic growth from the International Monetary Fund has weighed down the demand of oil. In addition, the gold price surged by 1.21% to $1841.62 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Year’s Day

All Day JPY Market Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Dec) | 17K | 15K | – |

| 17:30 | GBP – Manufacturing PMI (Dec) | 46.5 | 44.7 | – |

| 21:00 | EUR – German CPI (YoY) (Dec) | 10.0% | 9.1% | – |

Technical Analysis

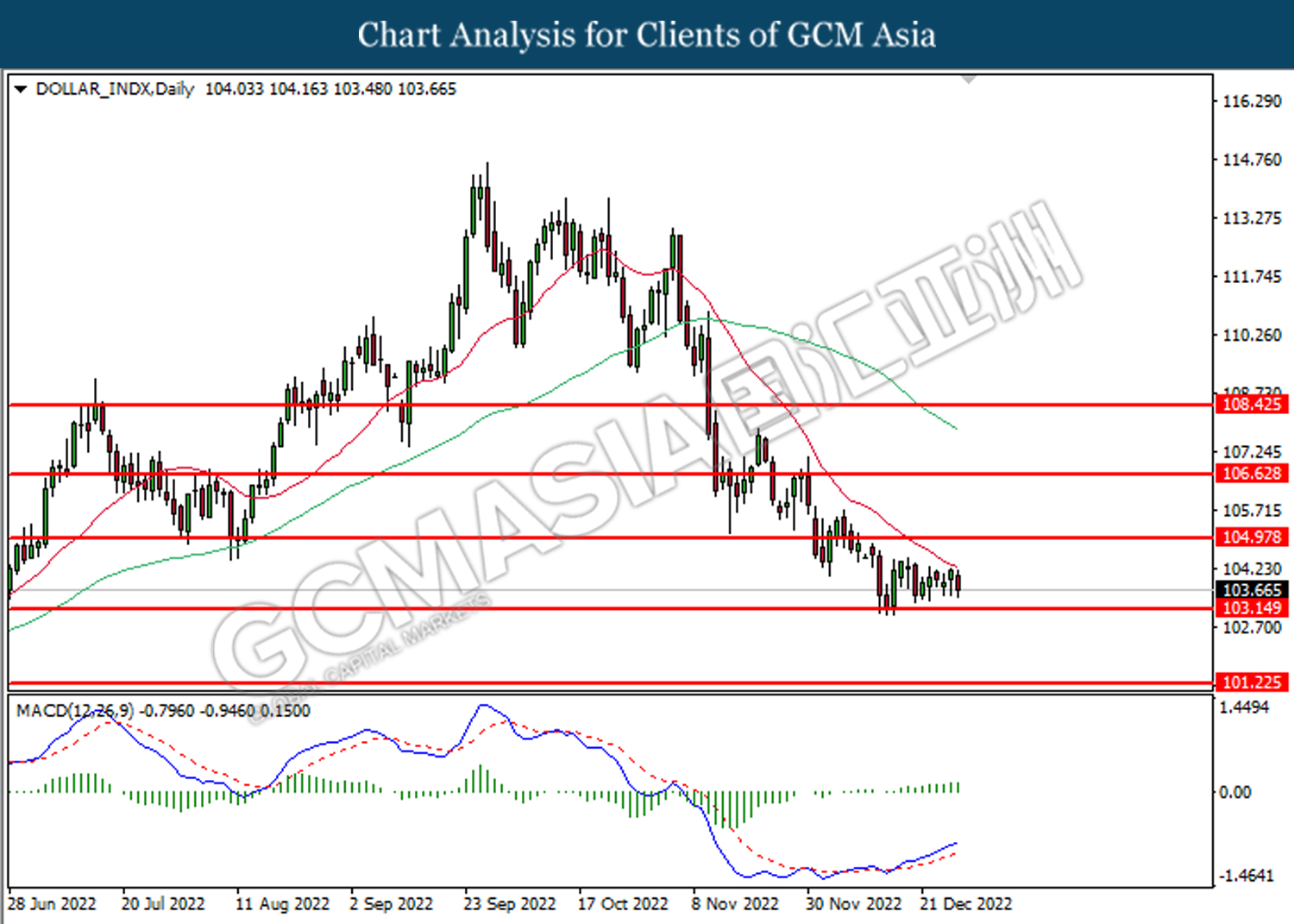

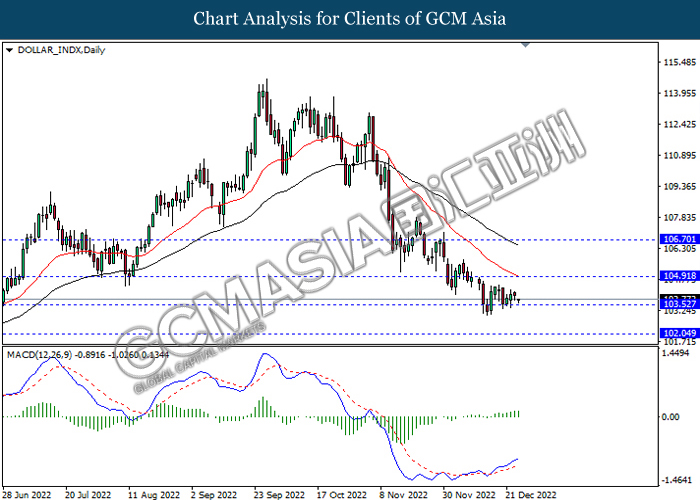

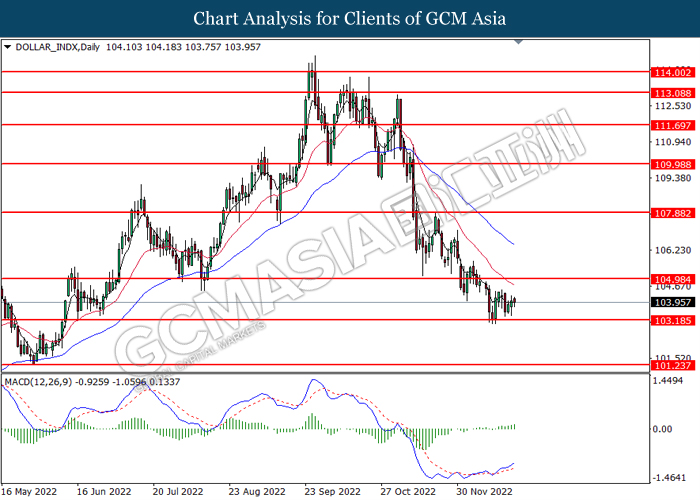

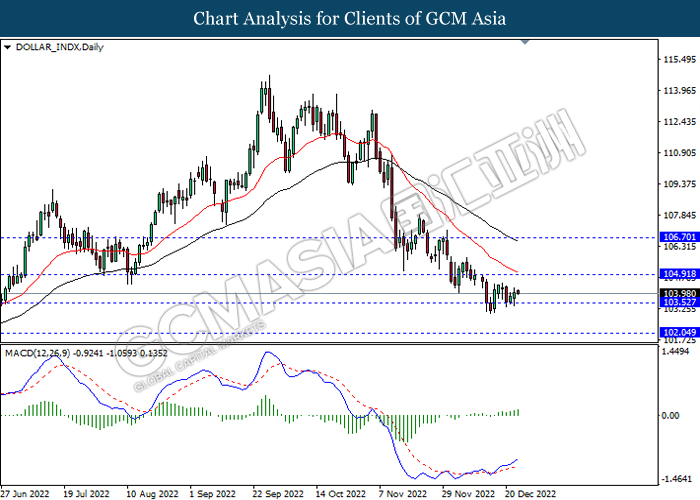

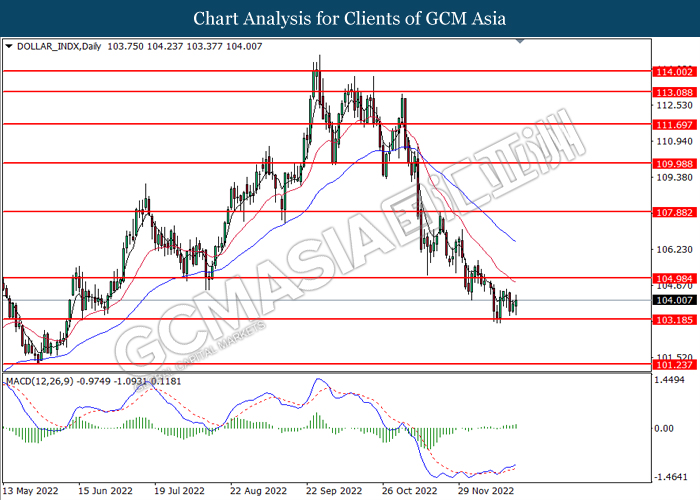

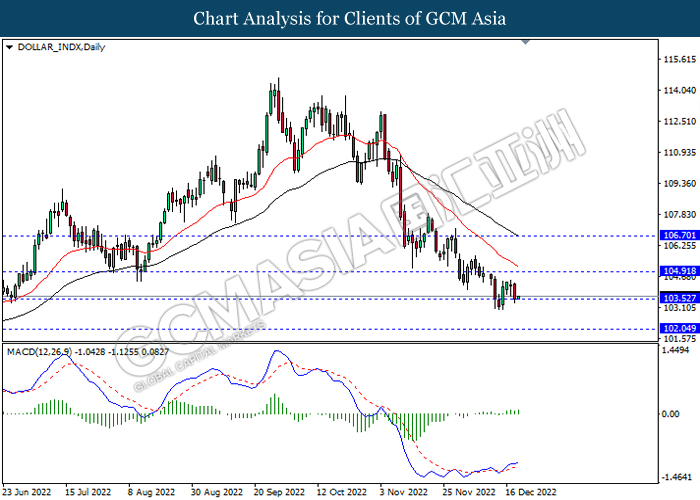

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.50, 104.90

Support level: 102.05, 100.55

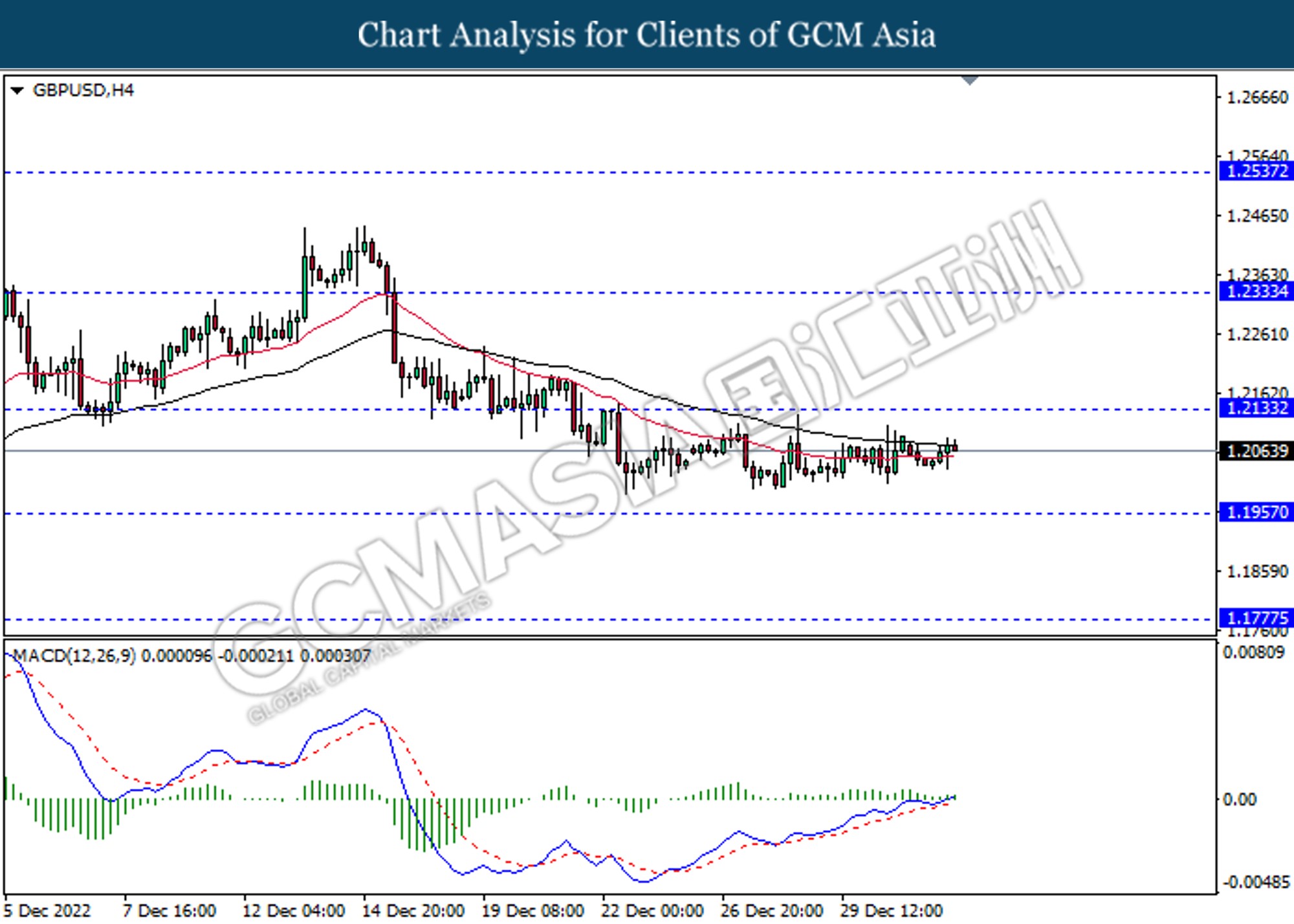

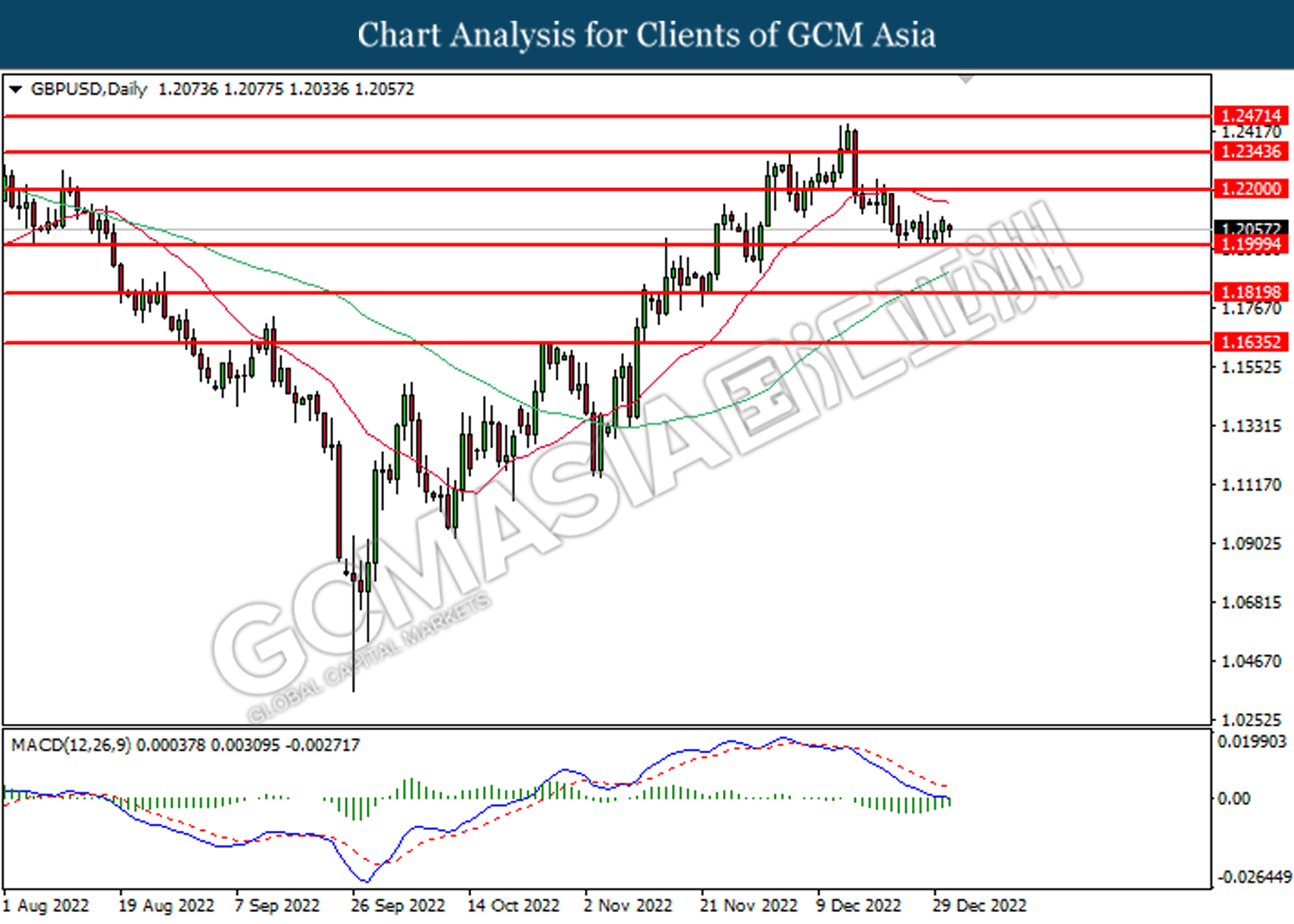

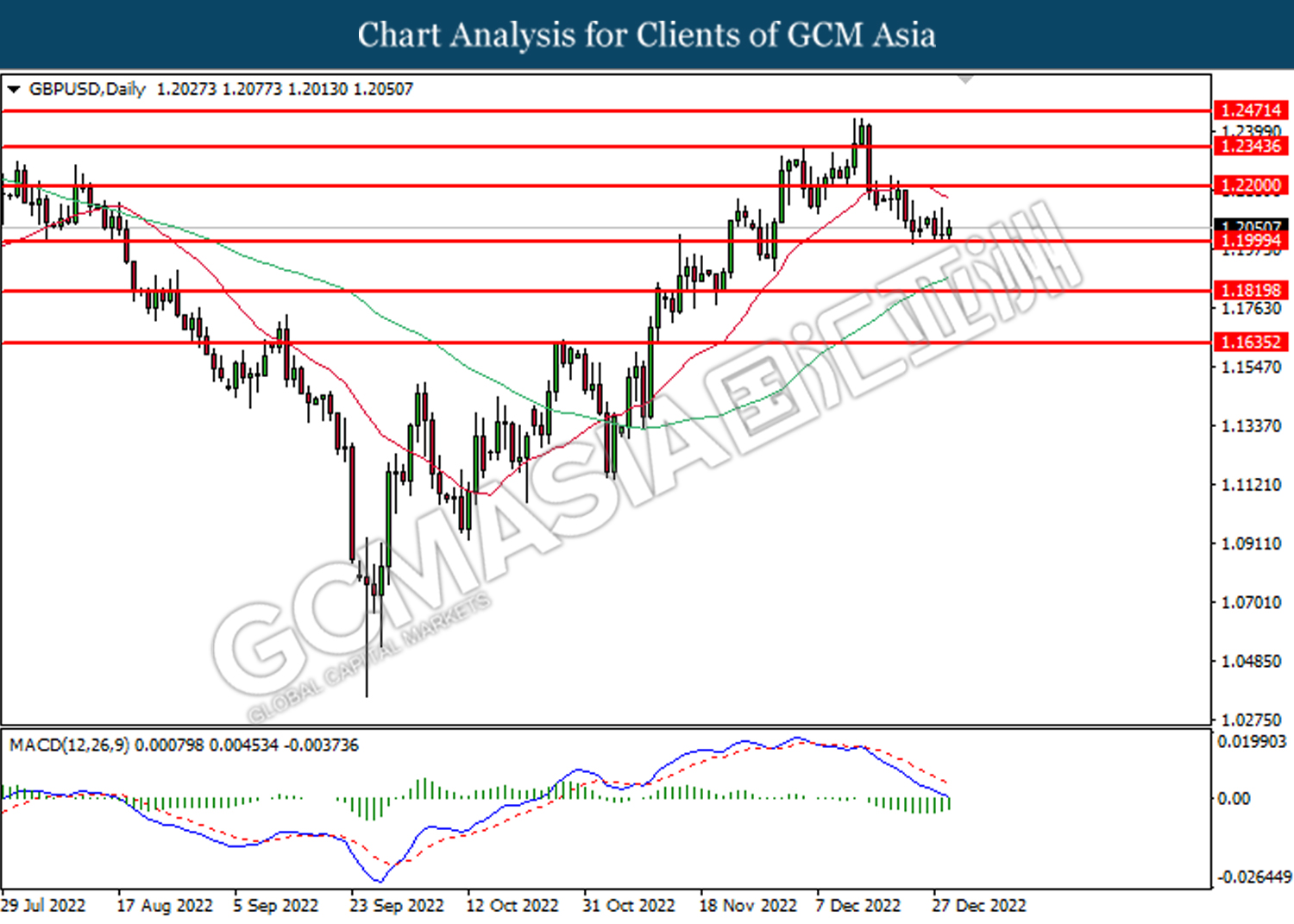

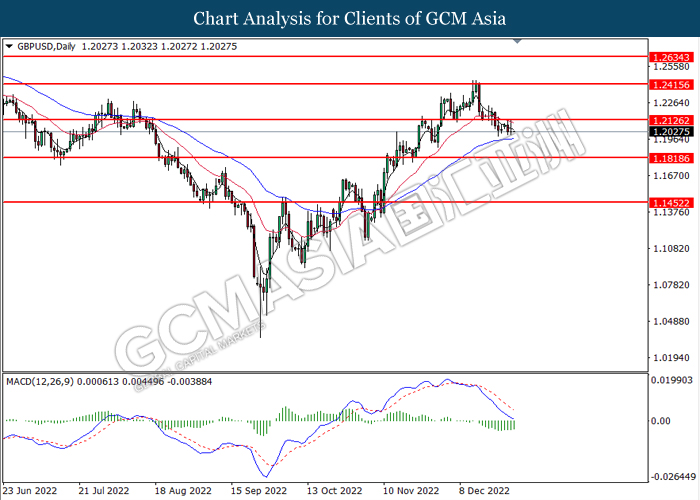

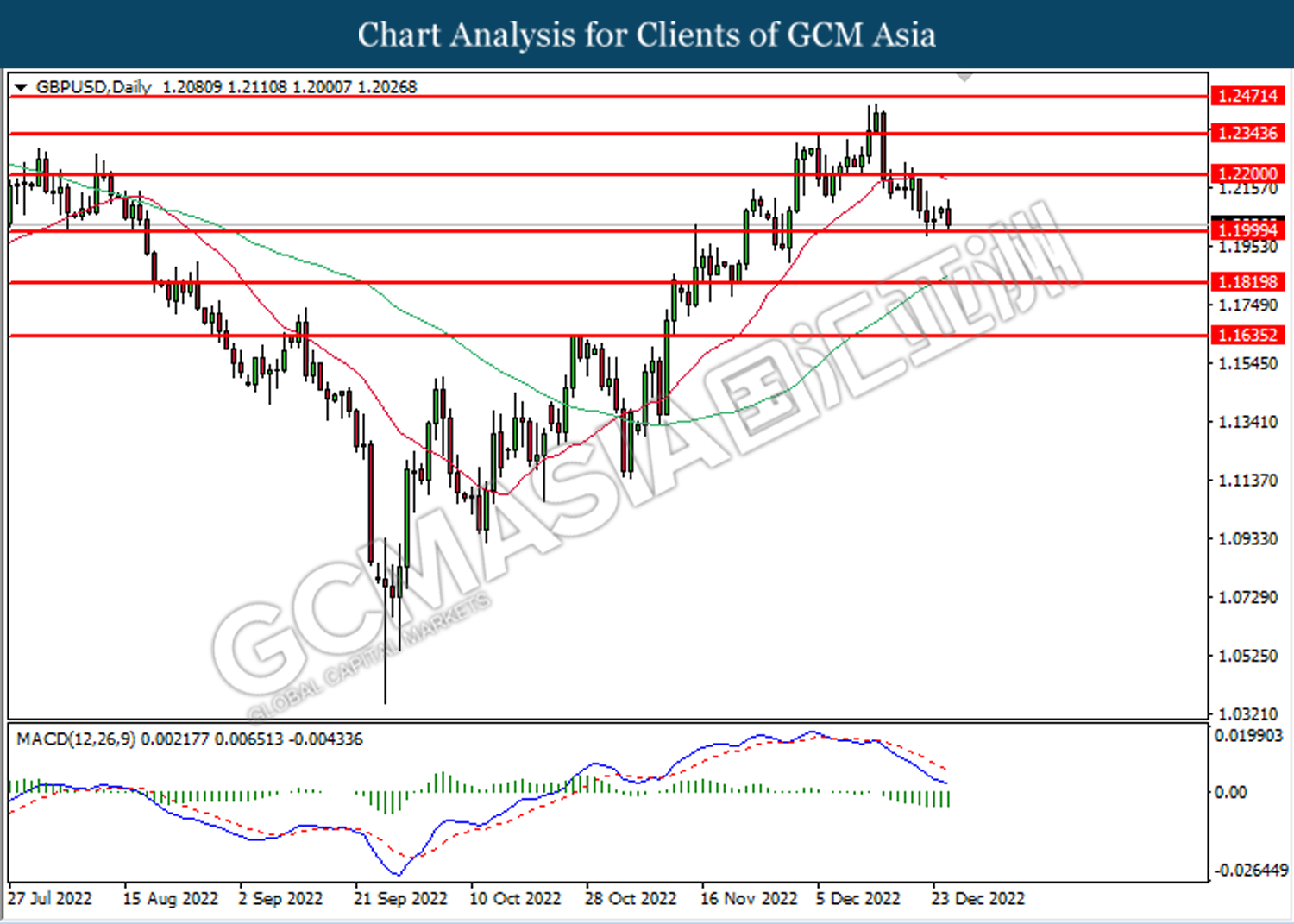

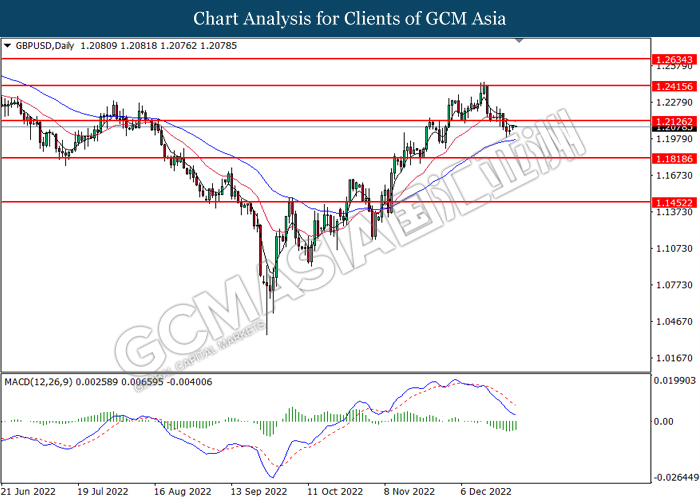

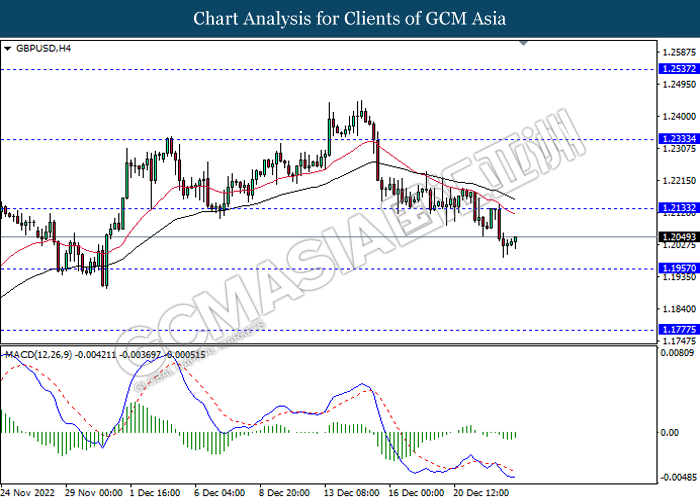

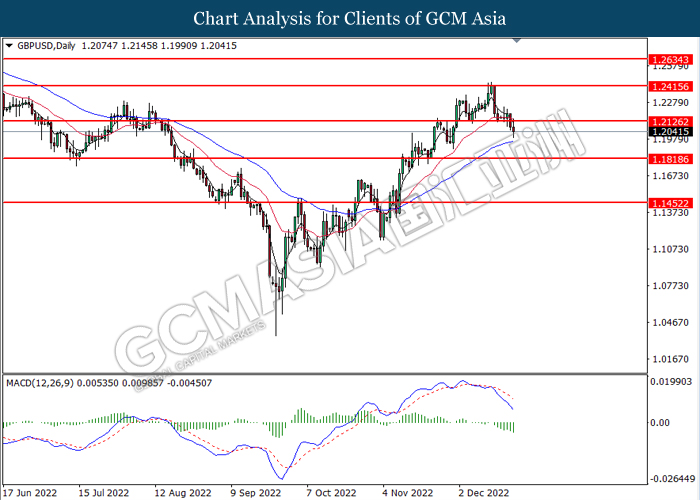

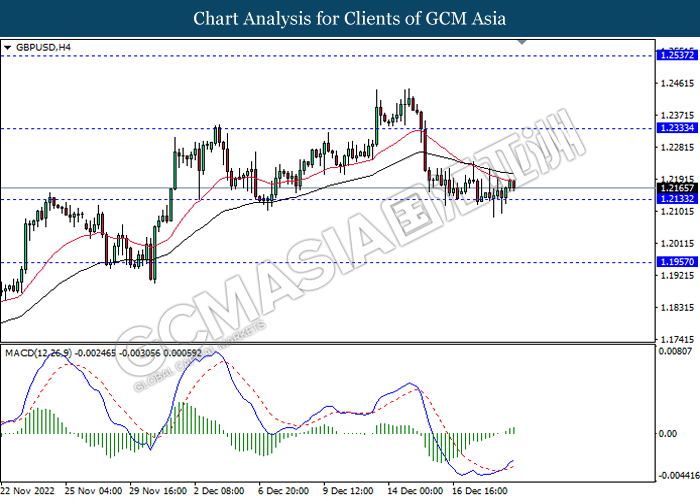

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

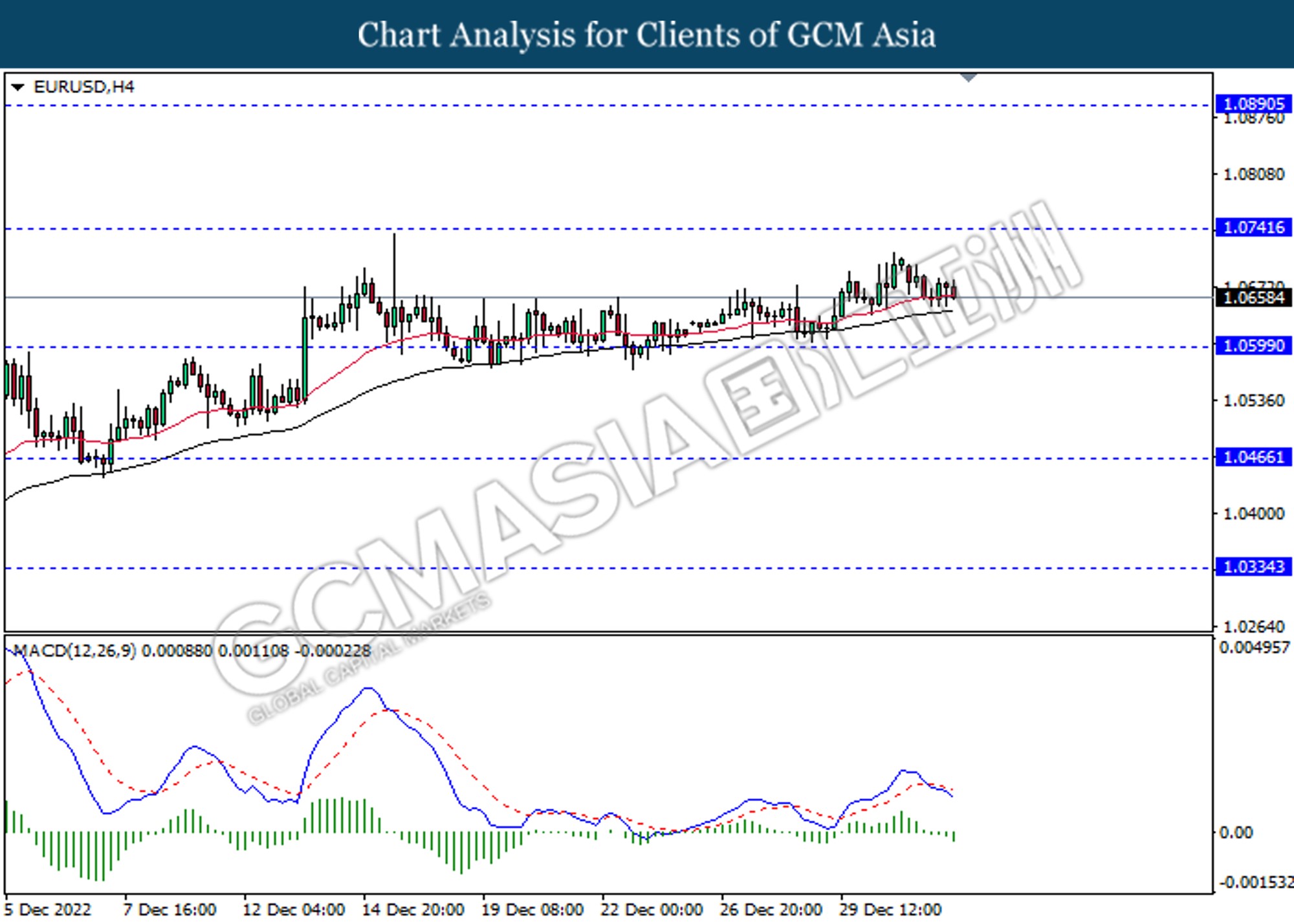

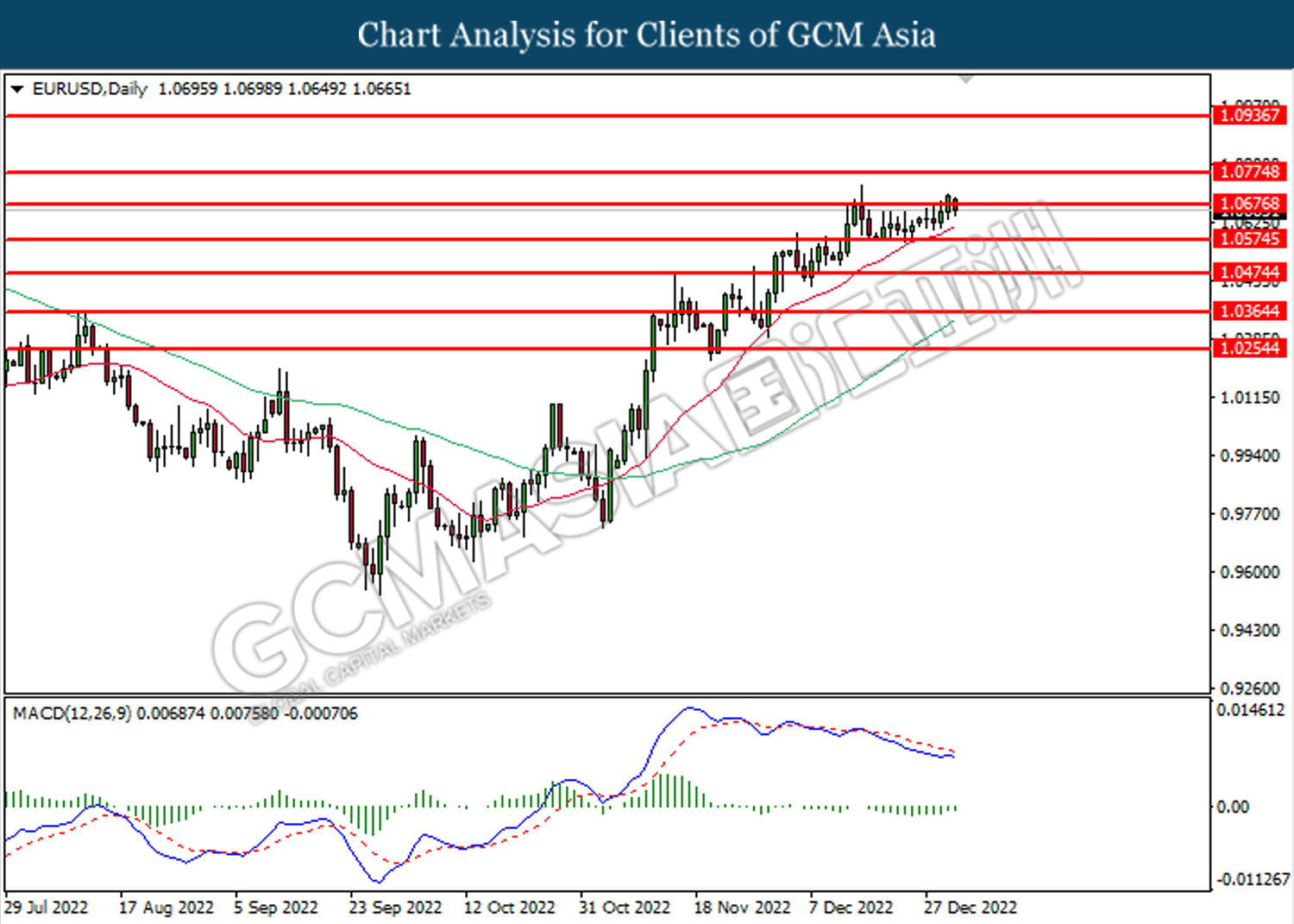

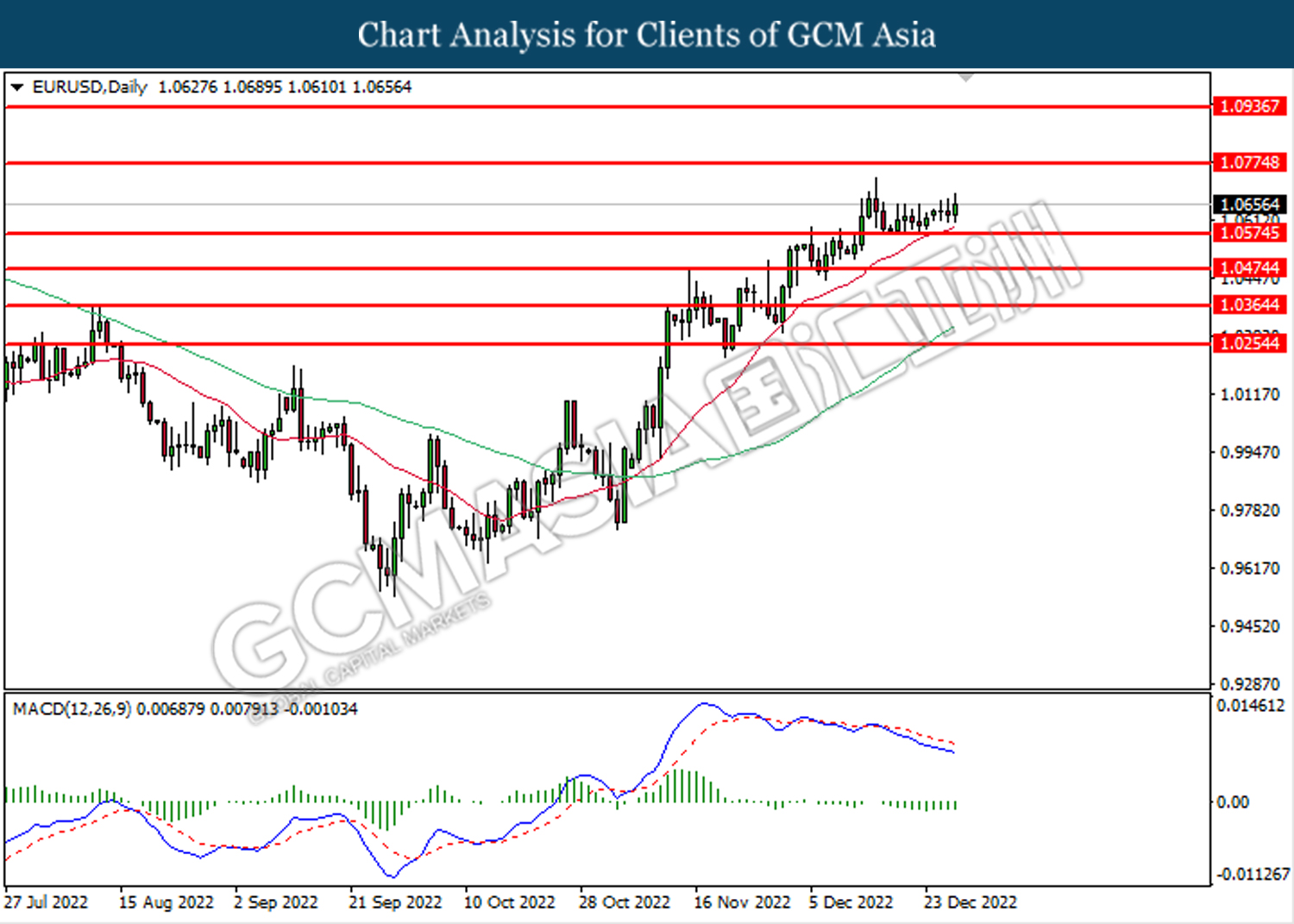

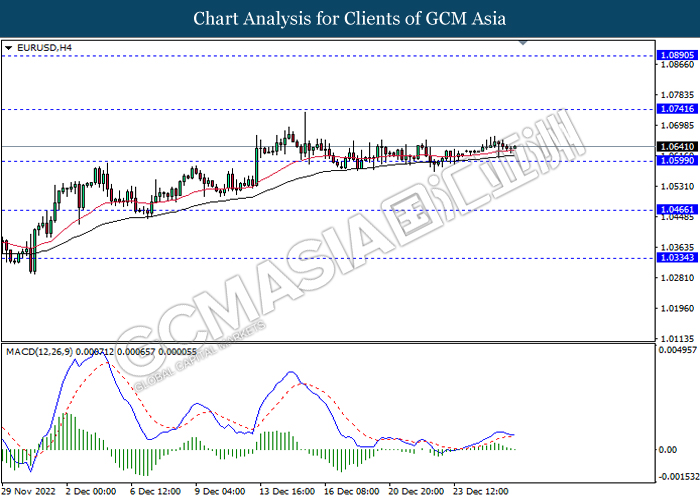

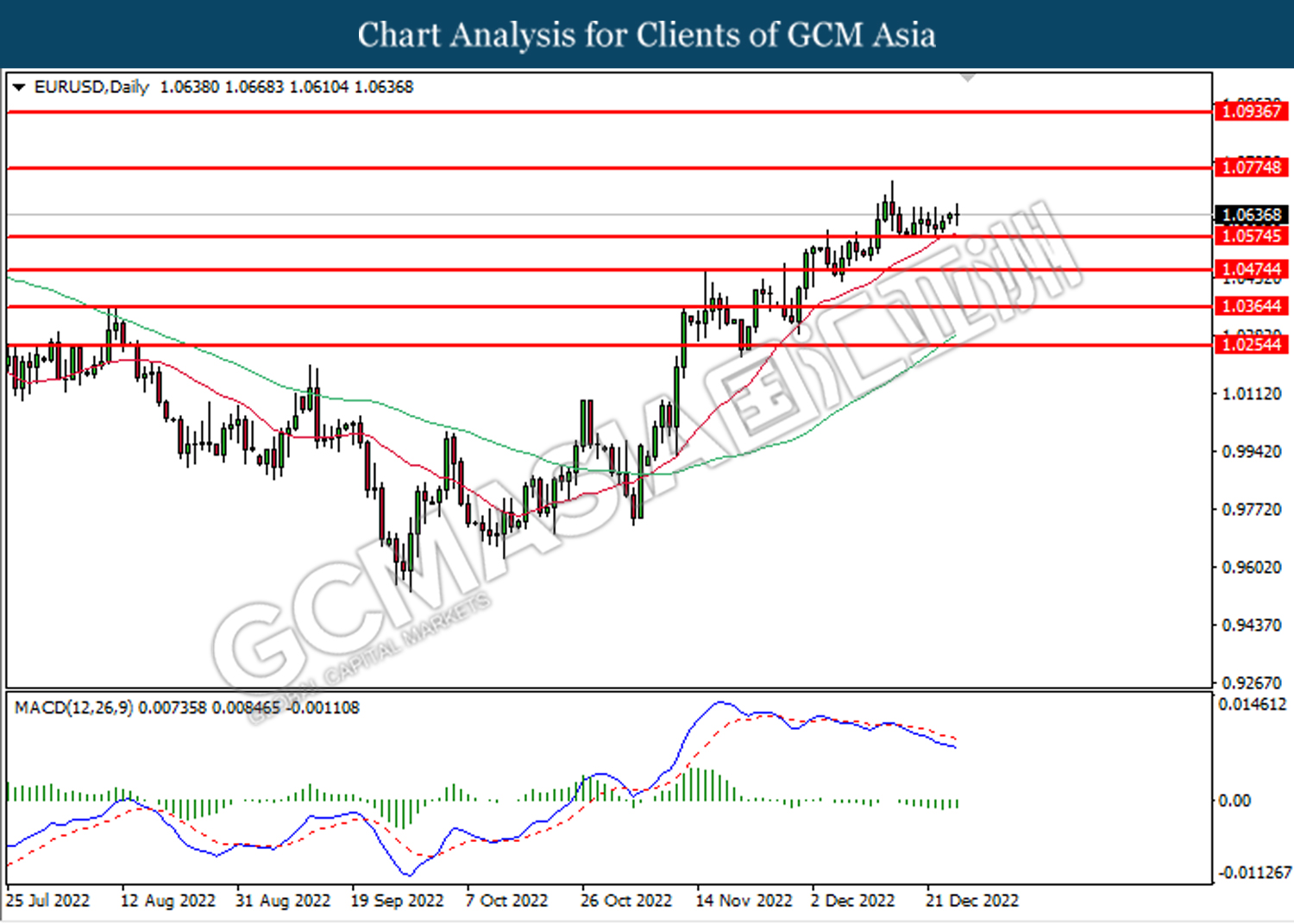

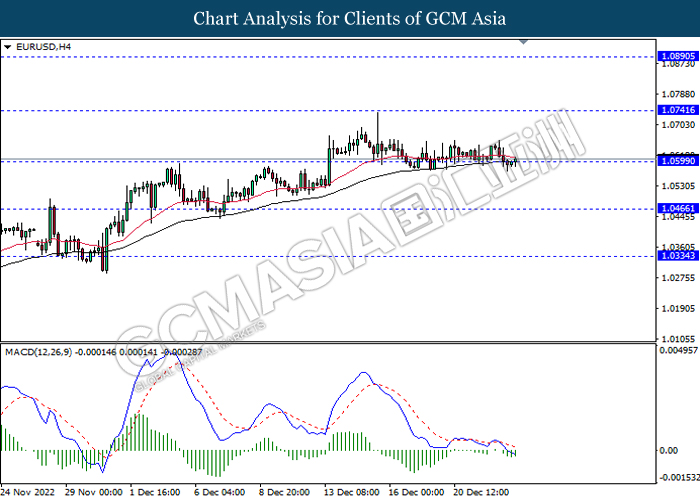

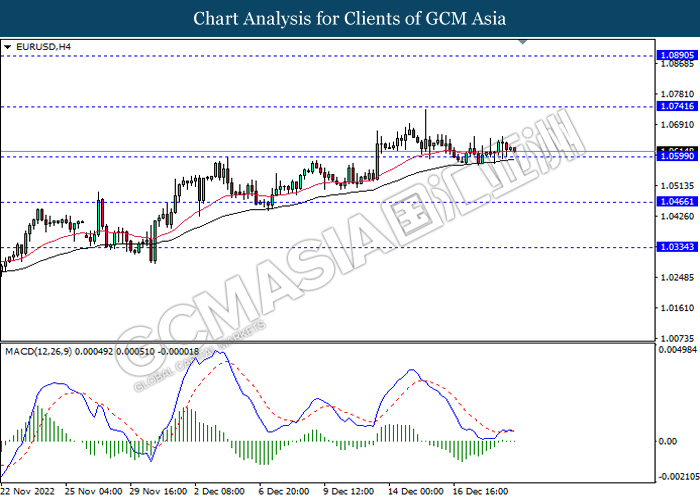

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

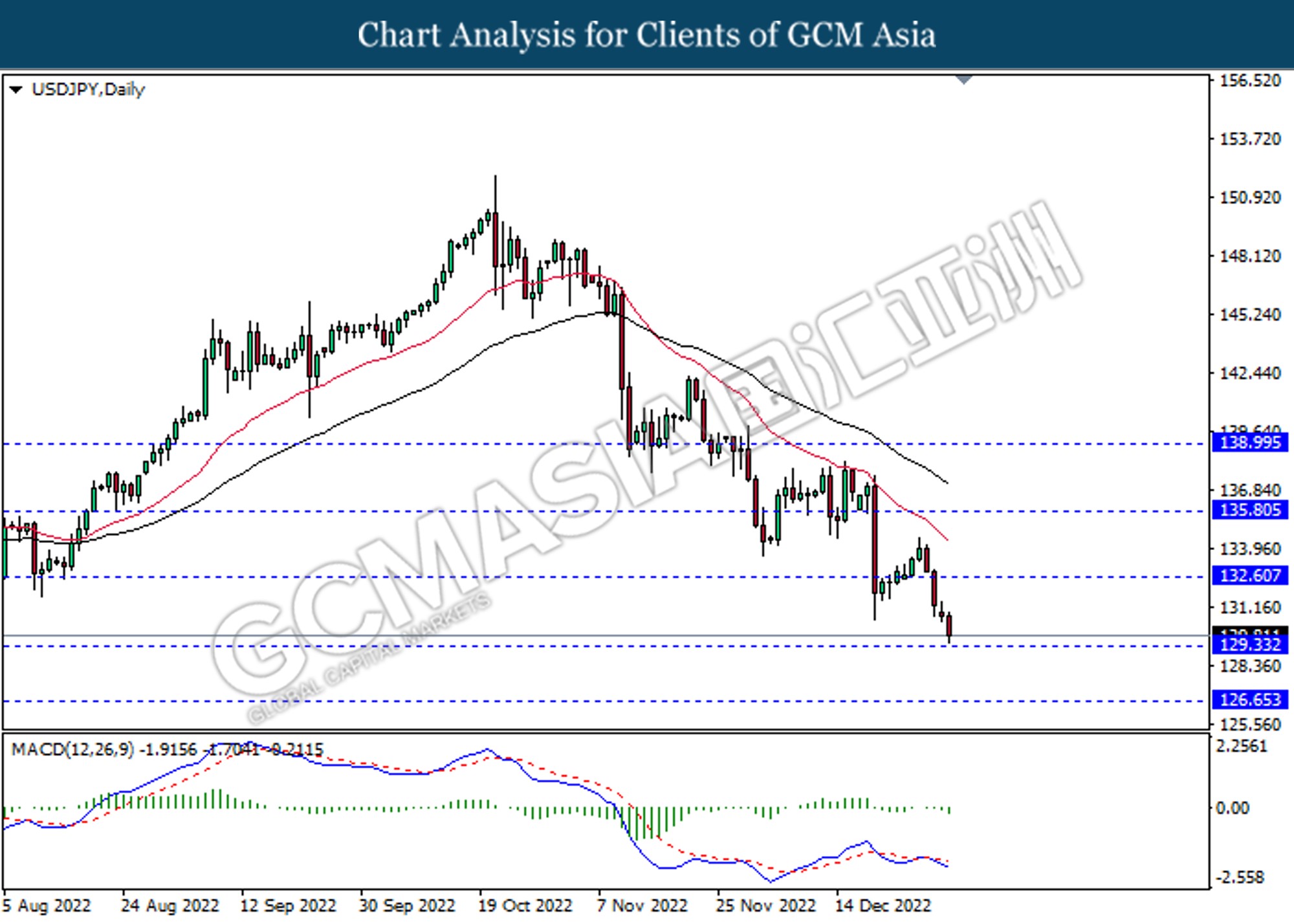

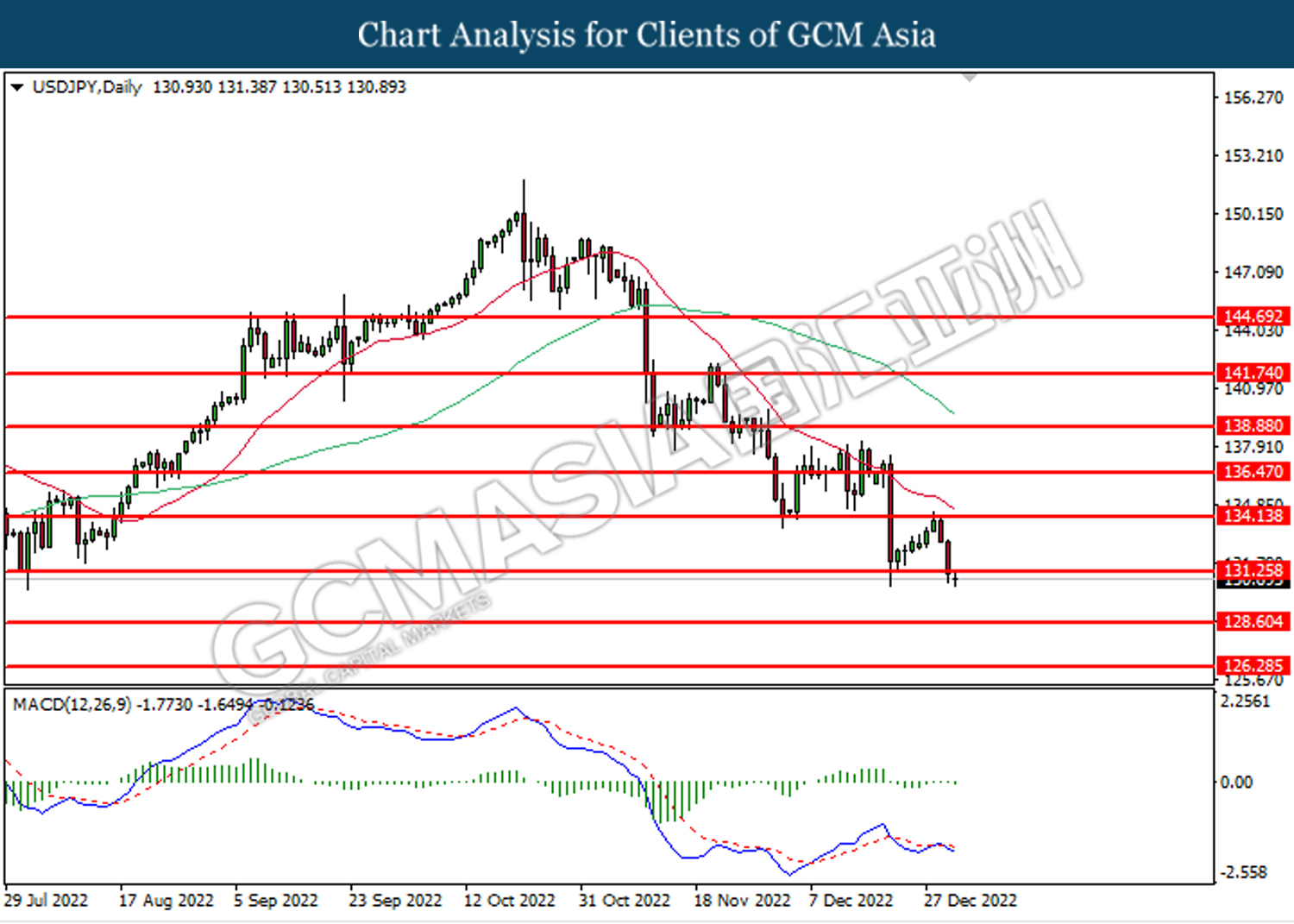

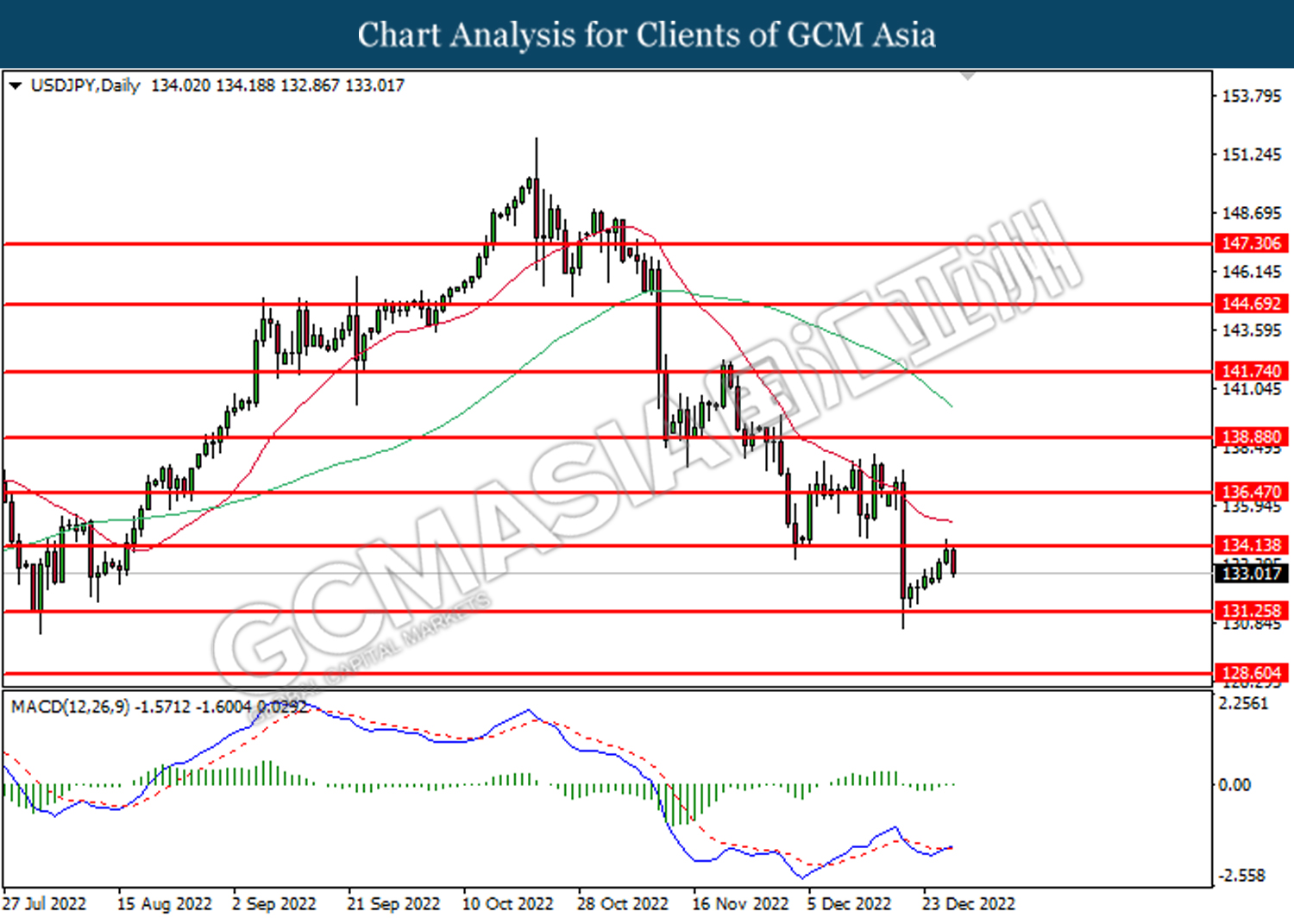

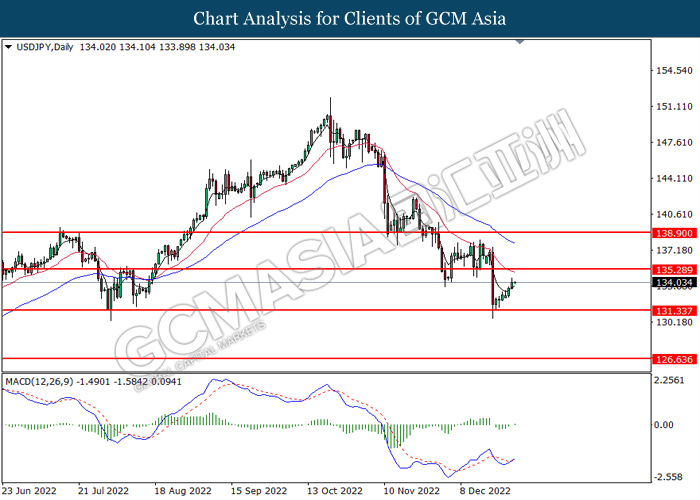

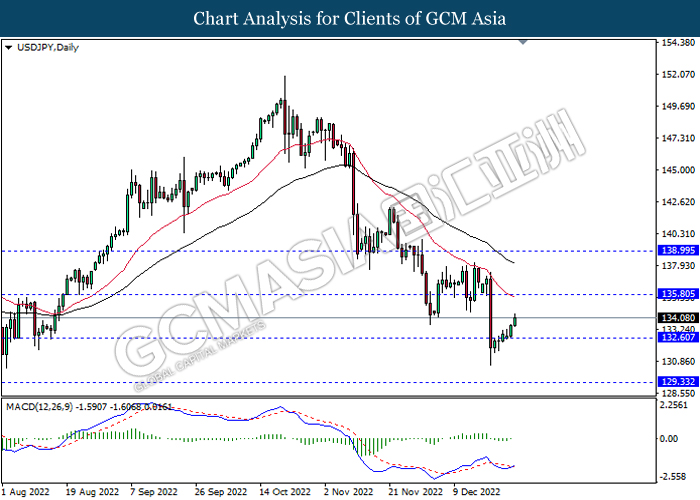

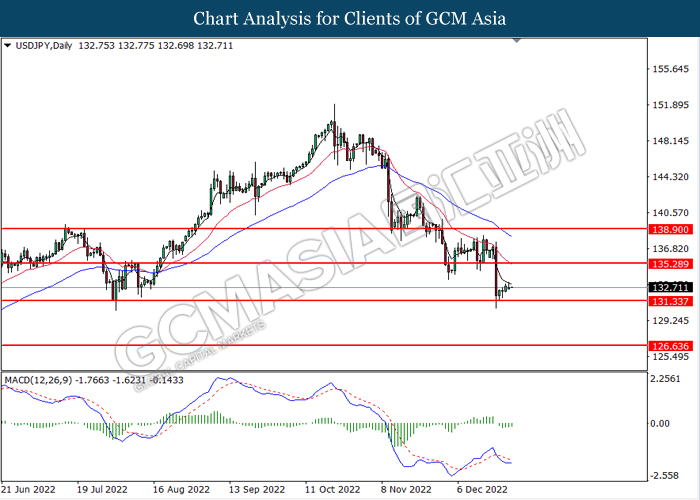

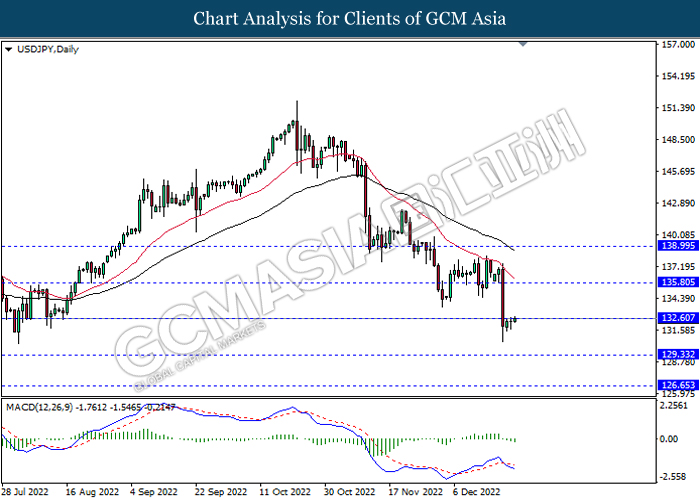

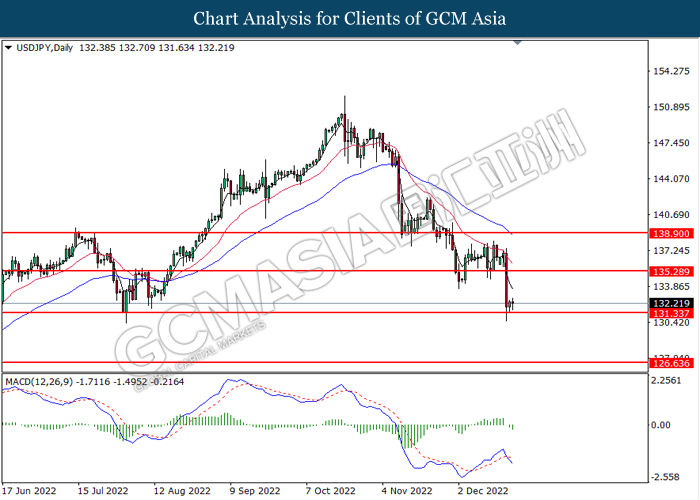

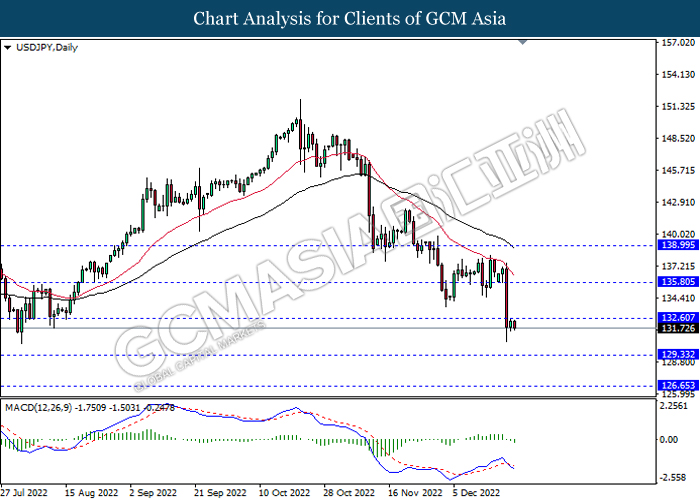

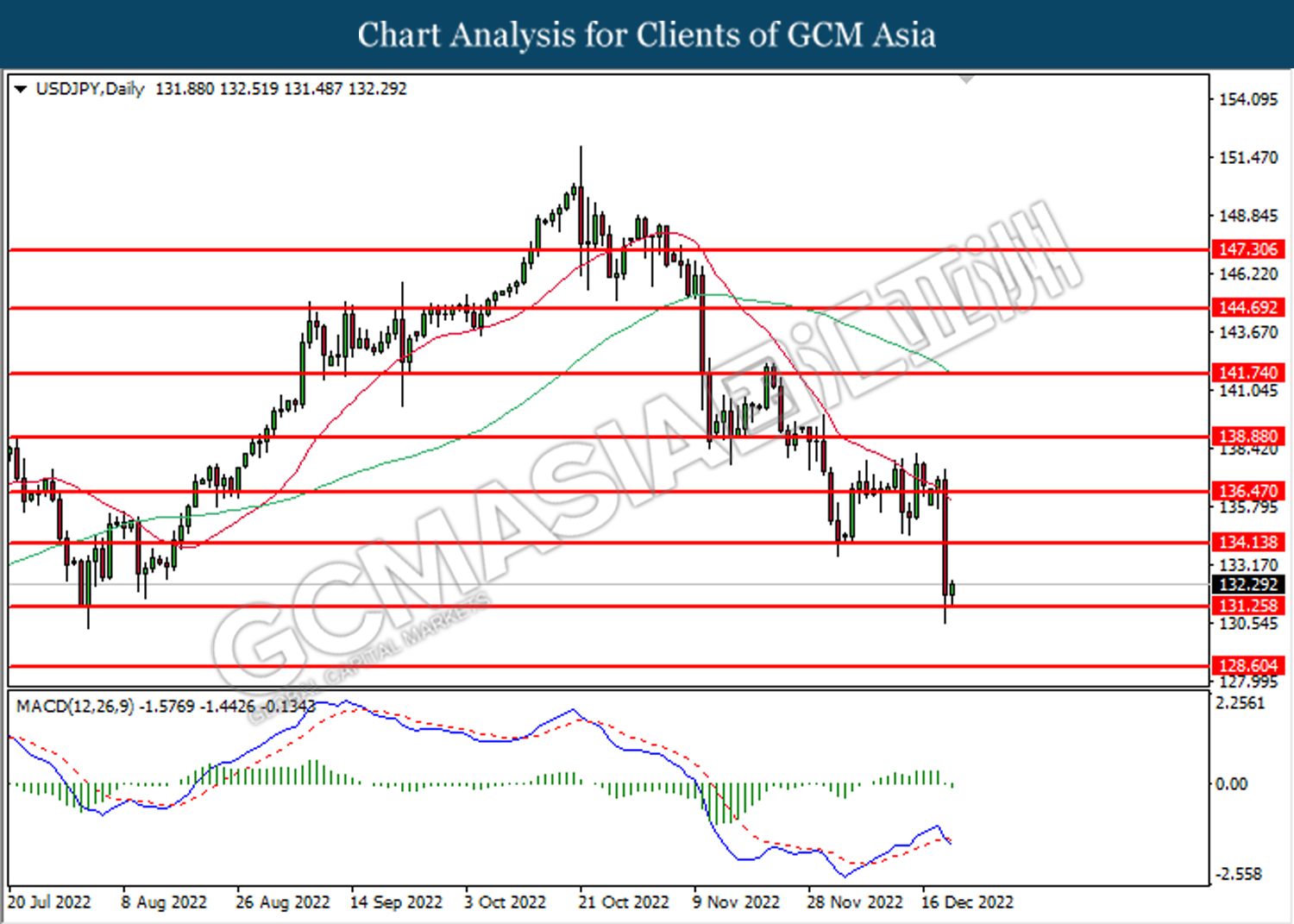

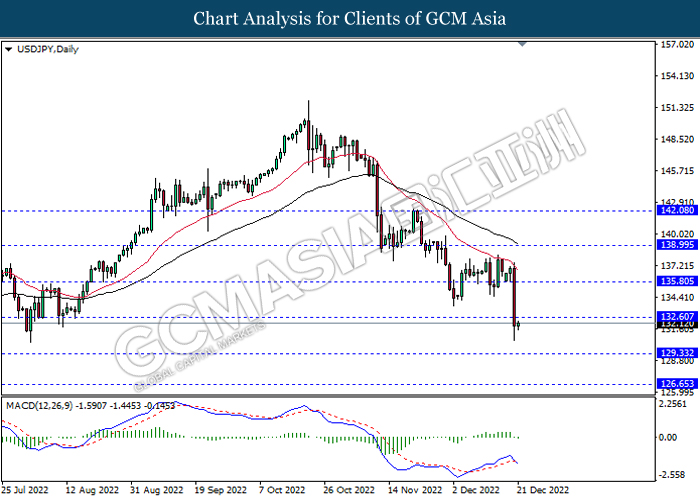

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

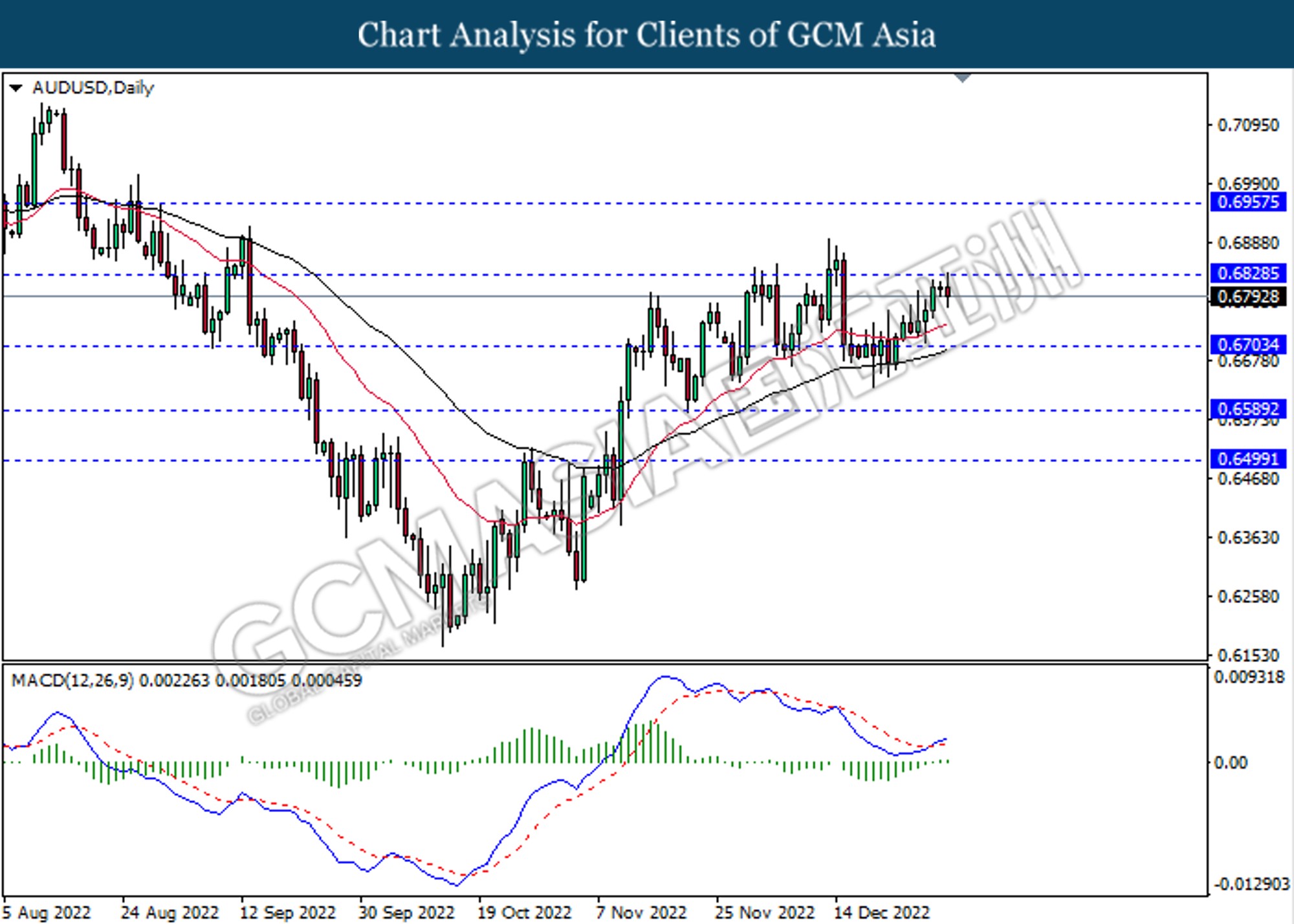

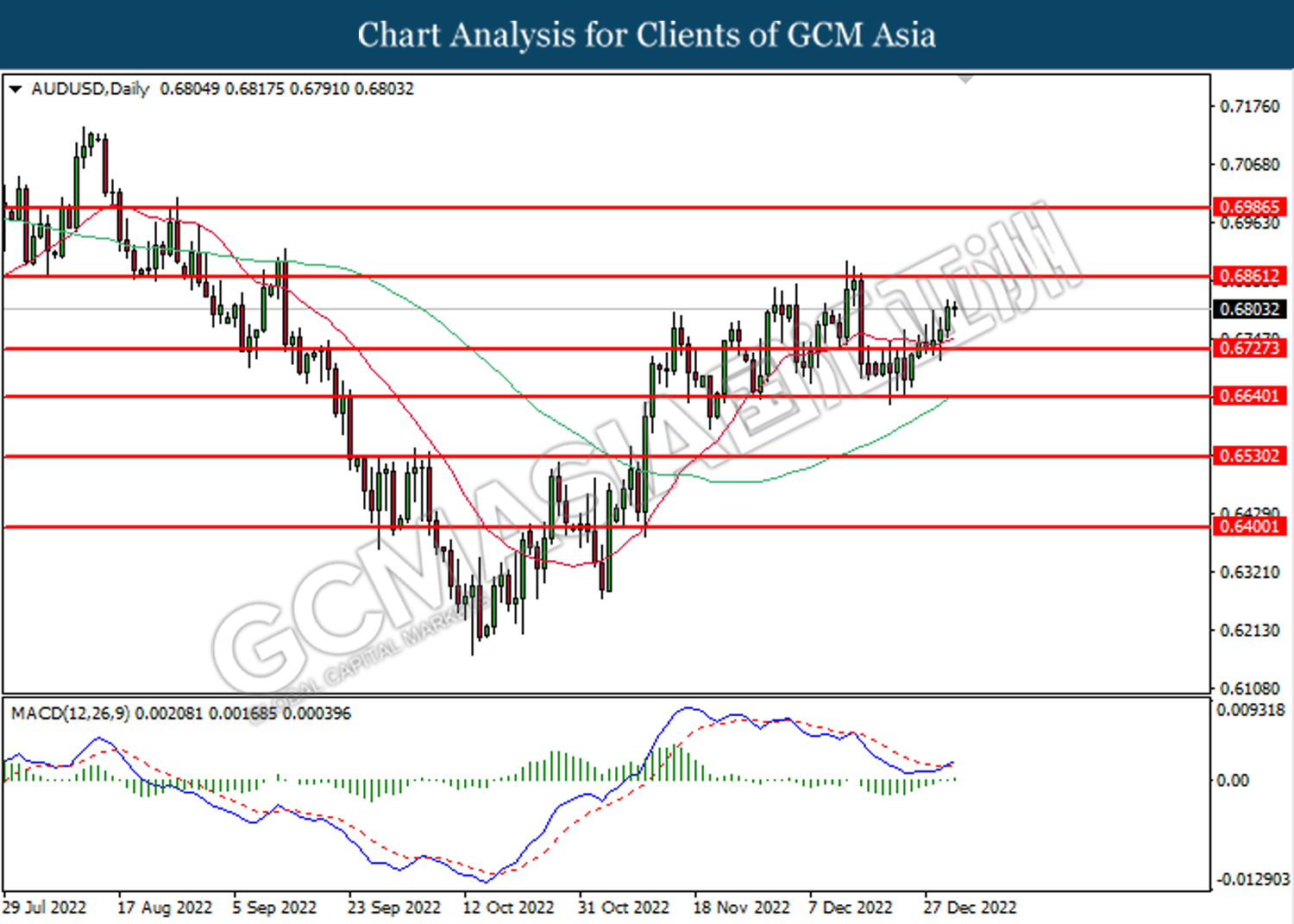

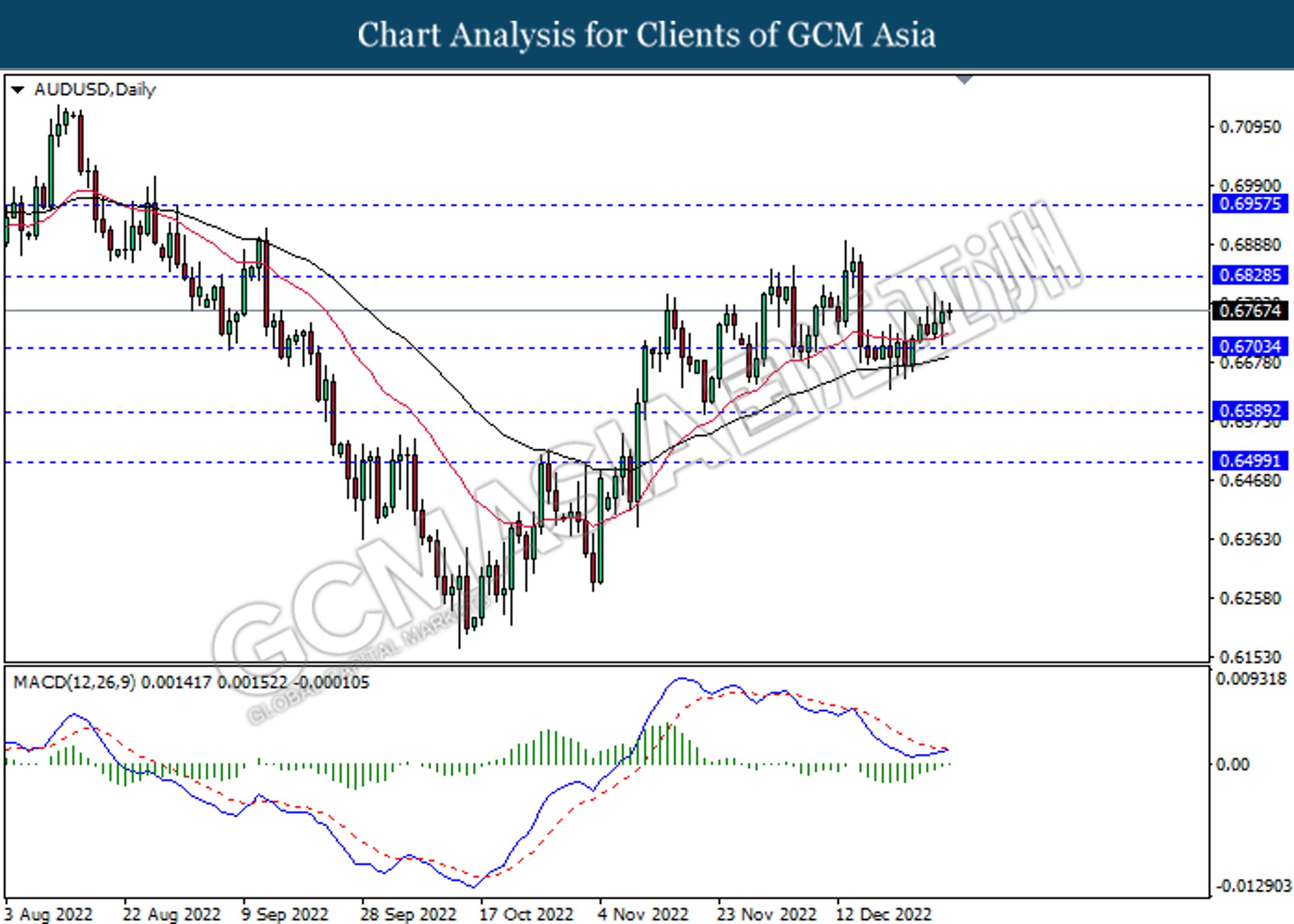

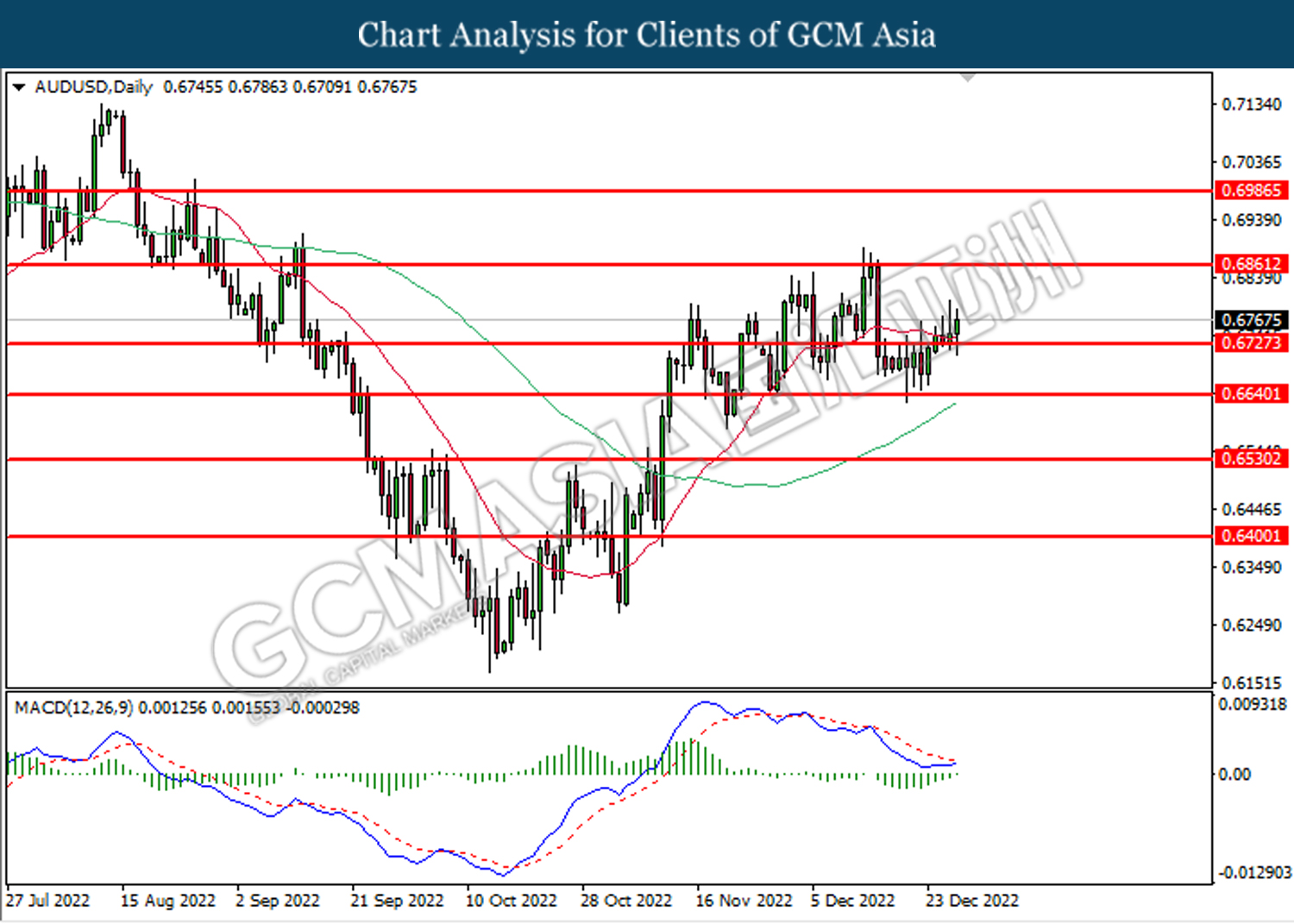

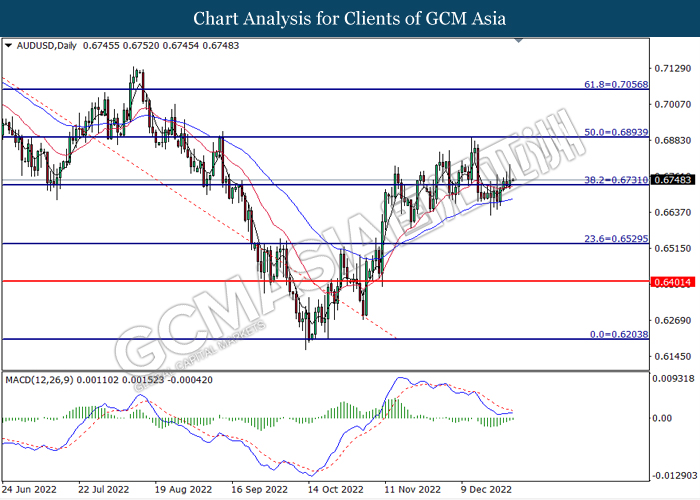

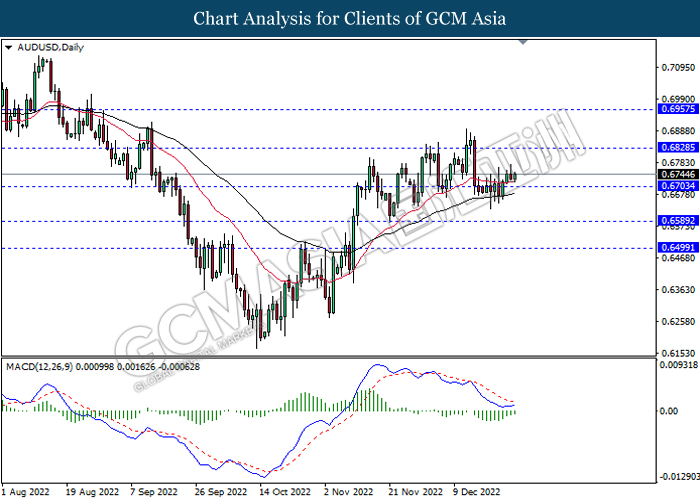

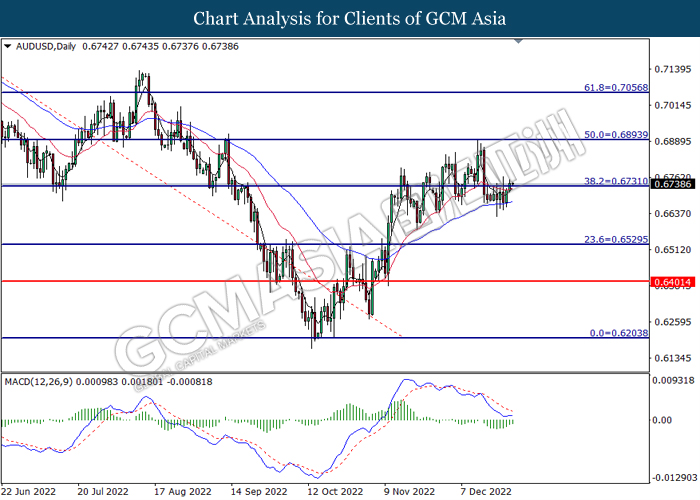

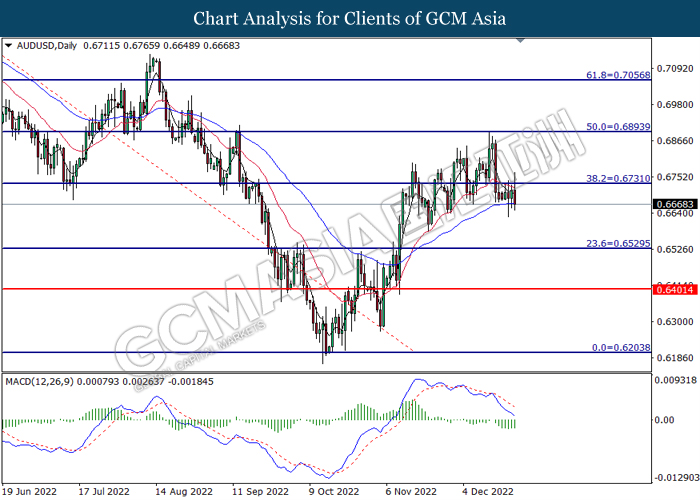

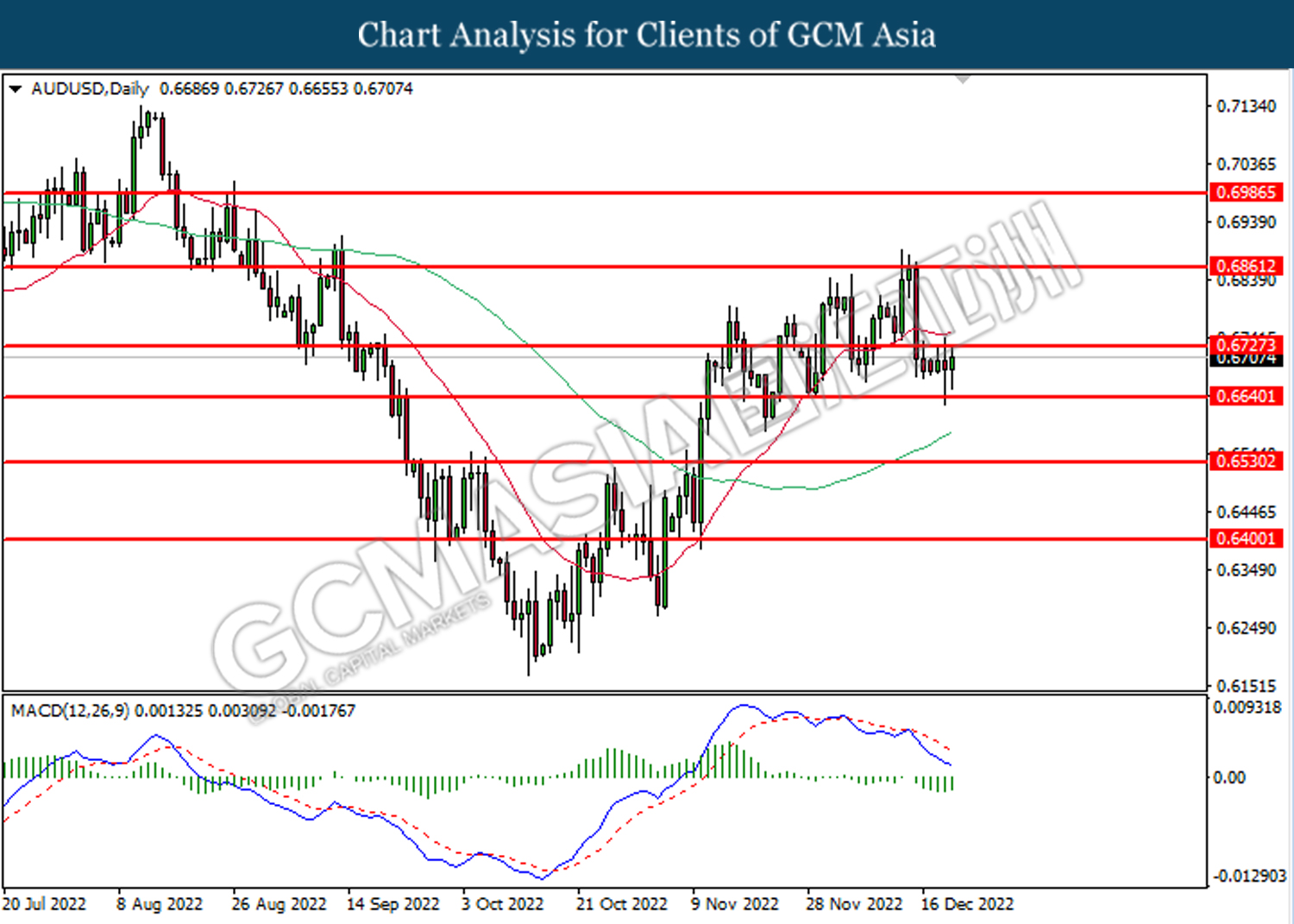

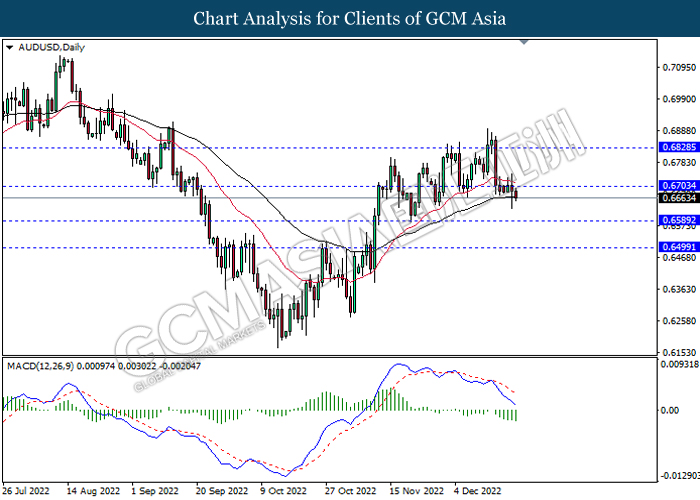

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

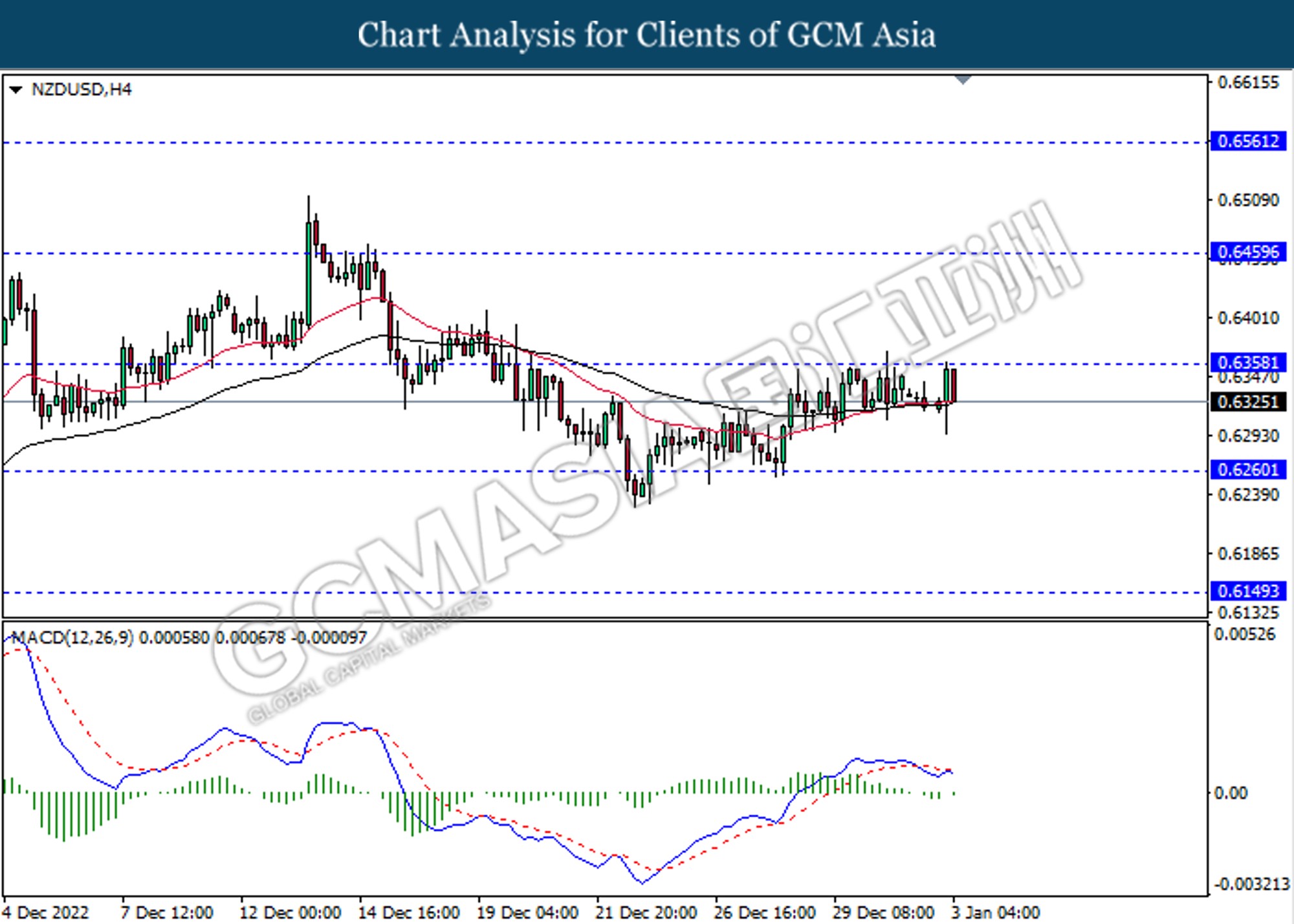

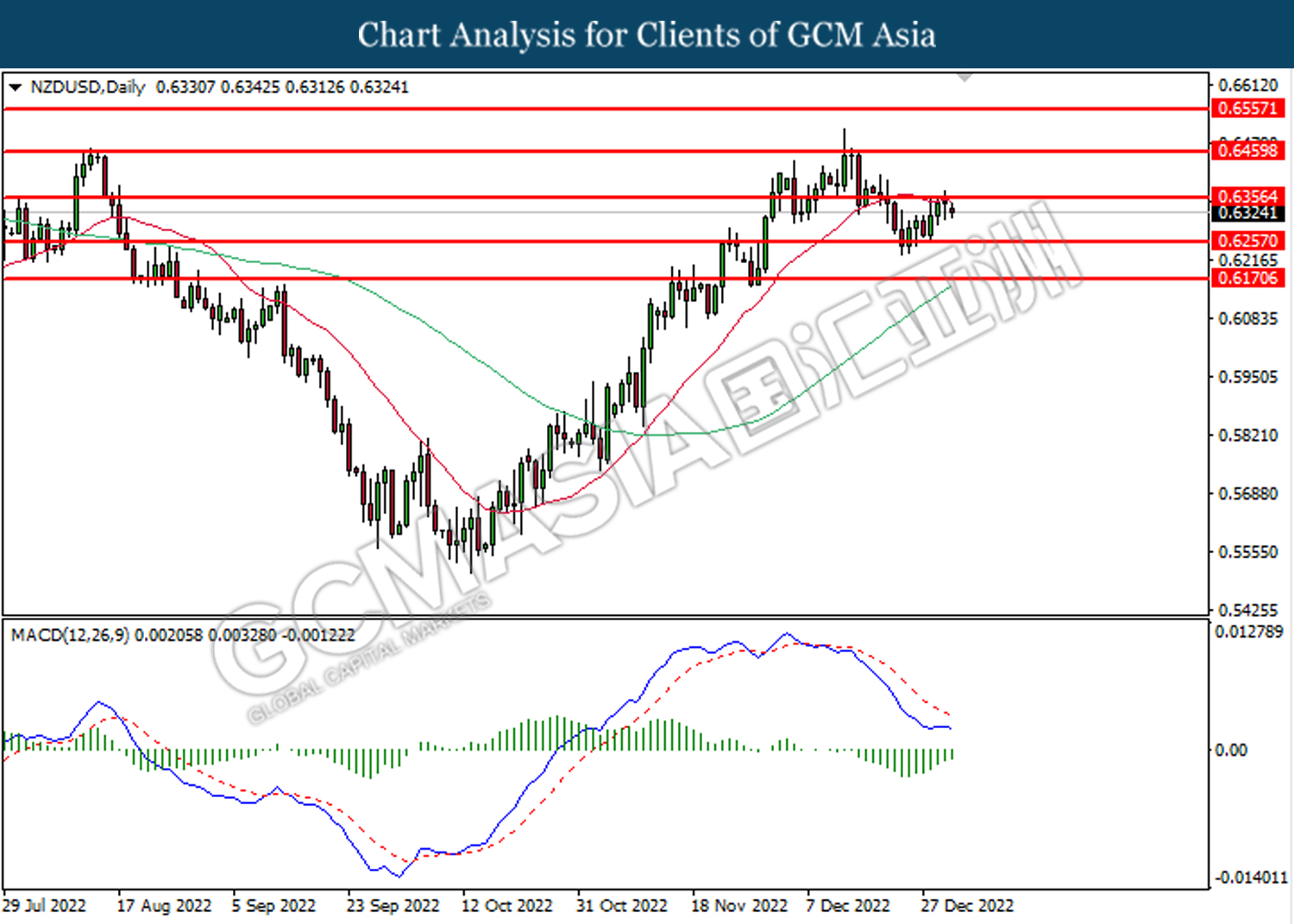

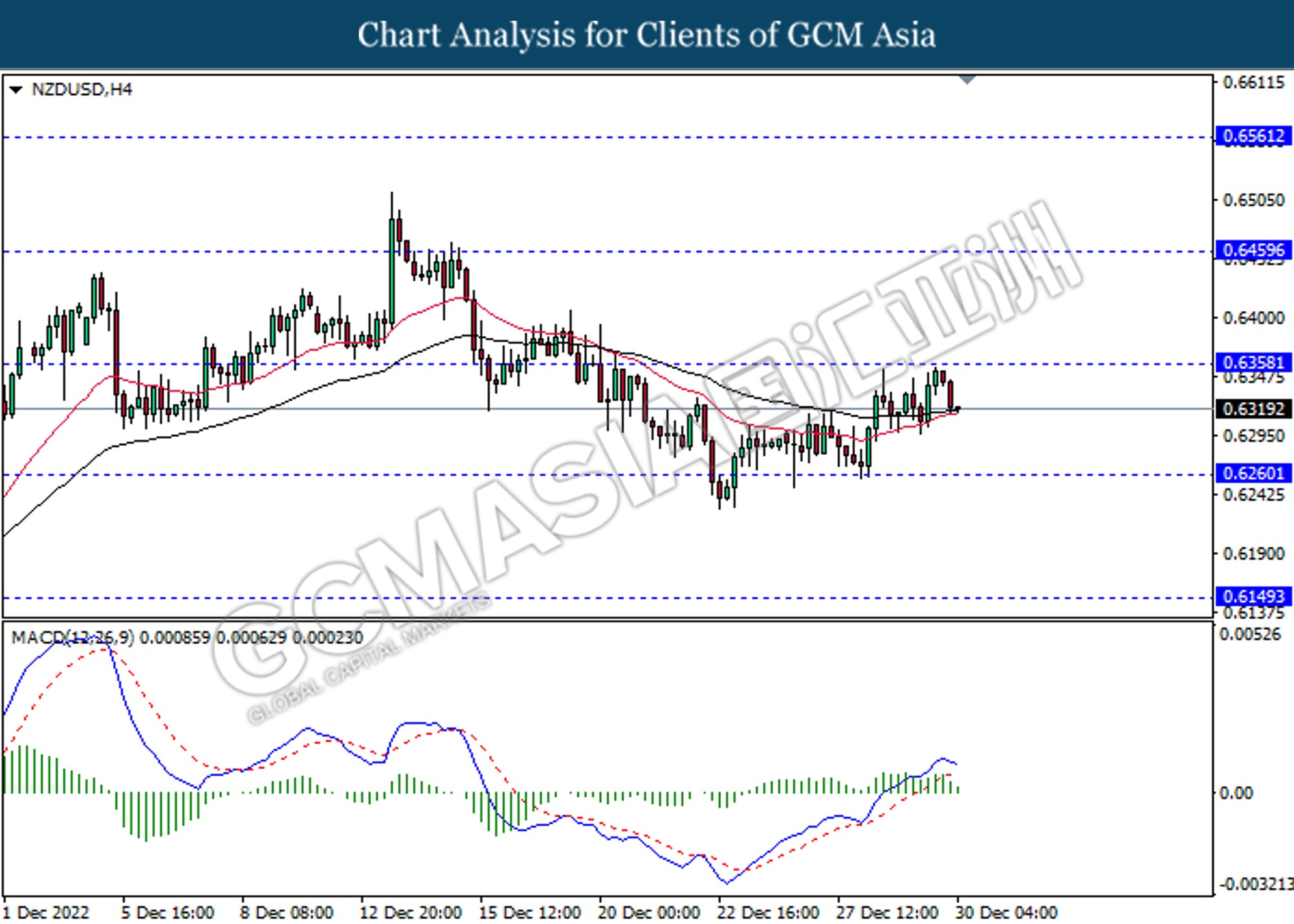

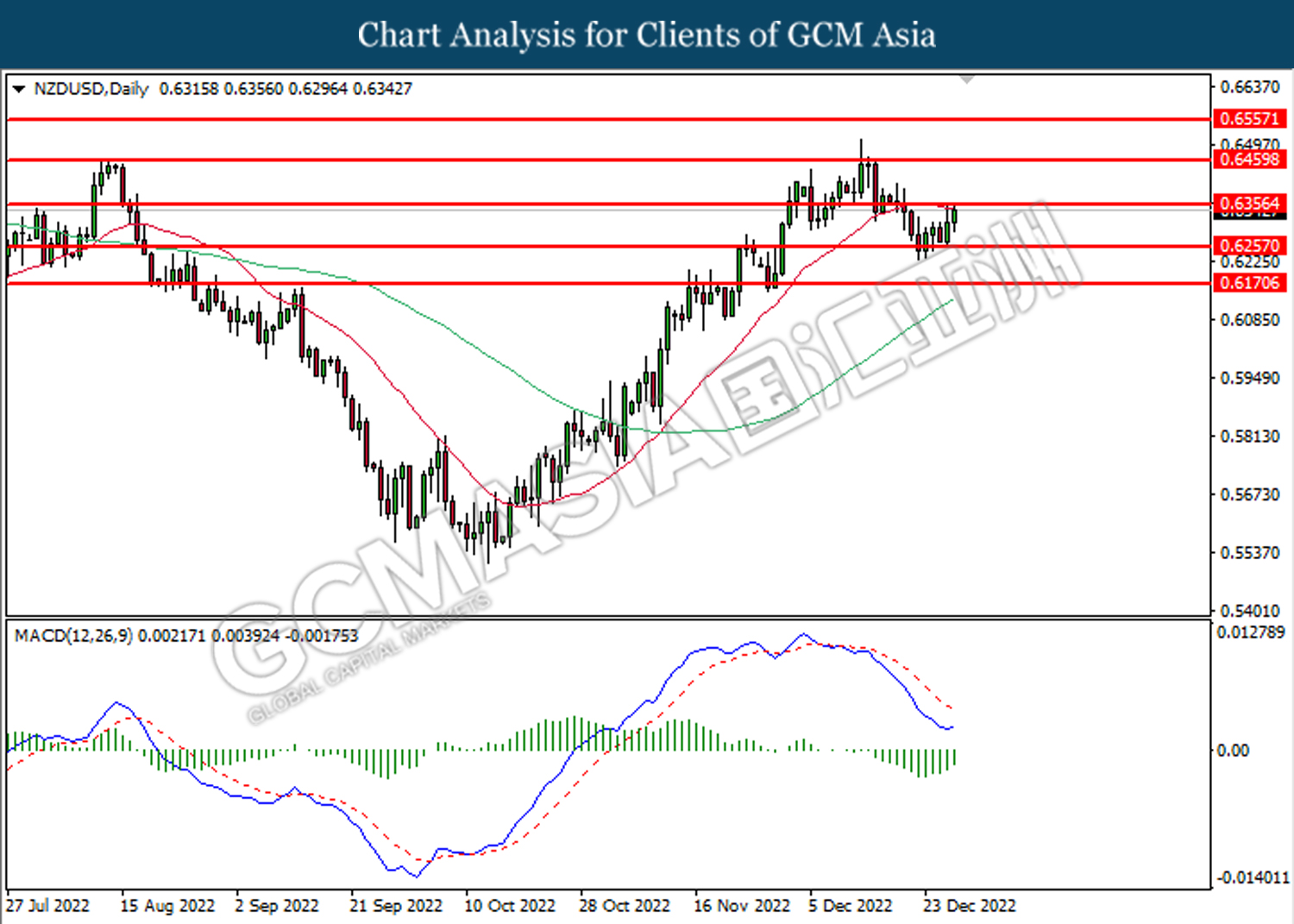

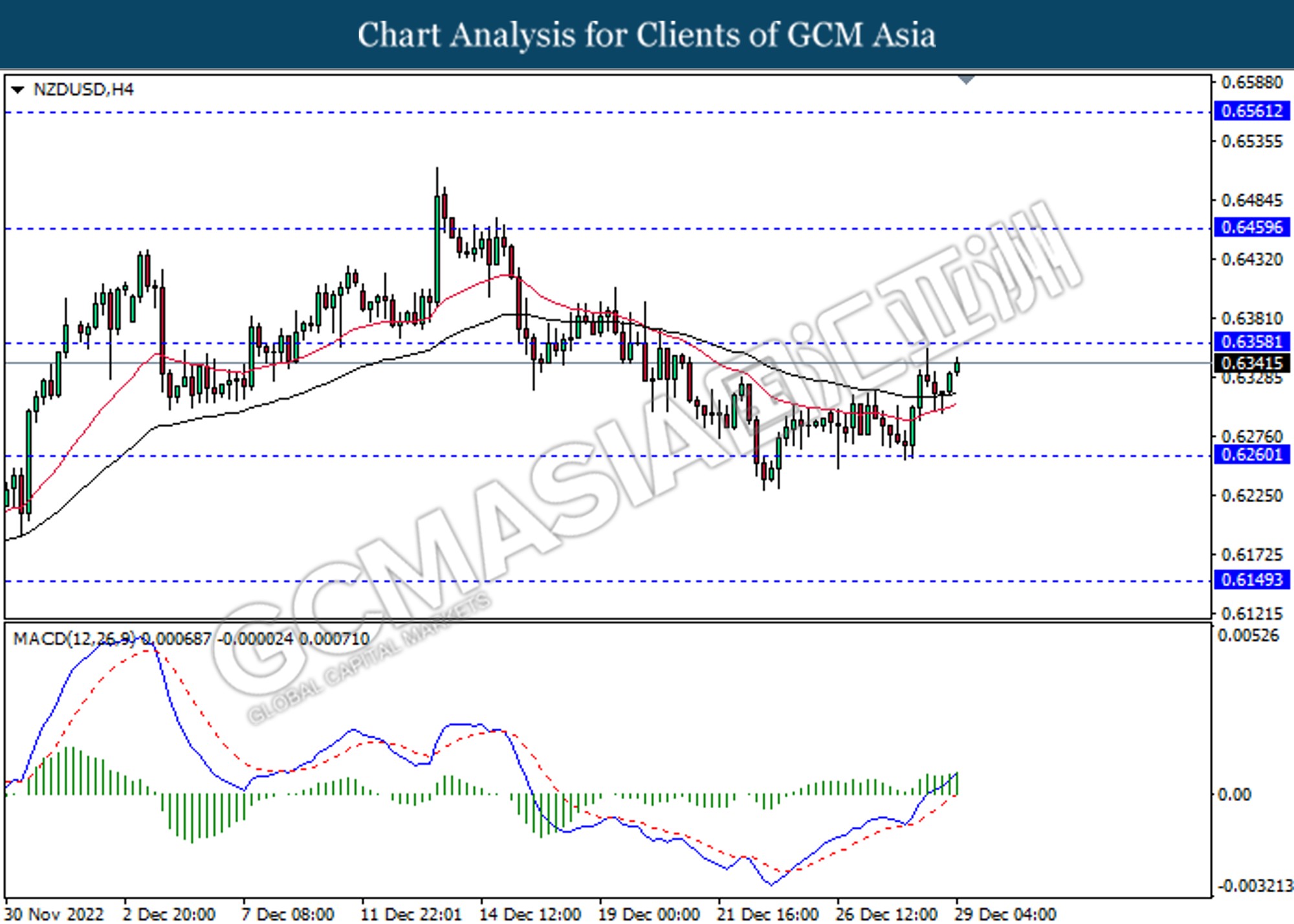

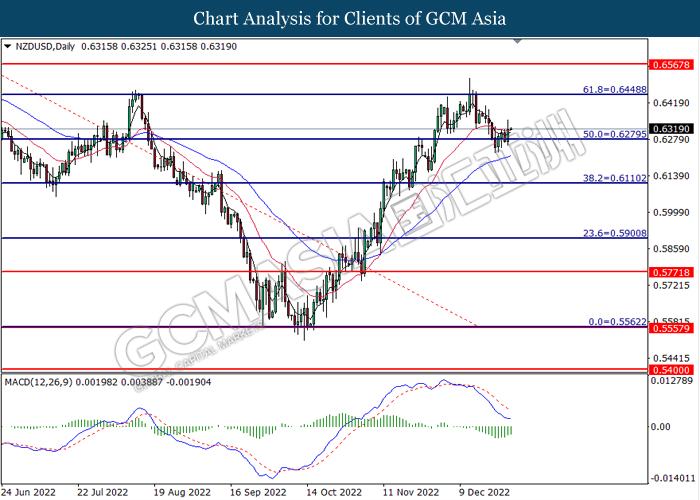

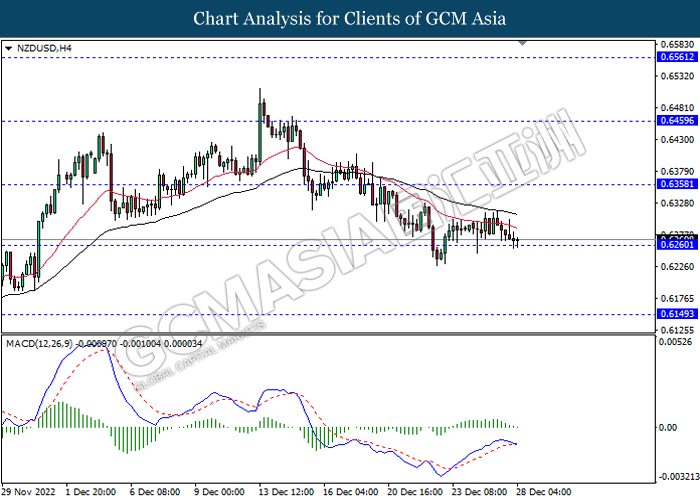

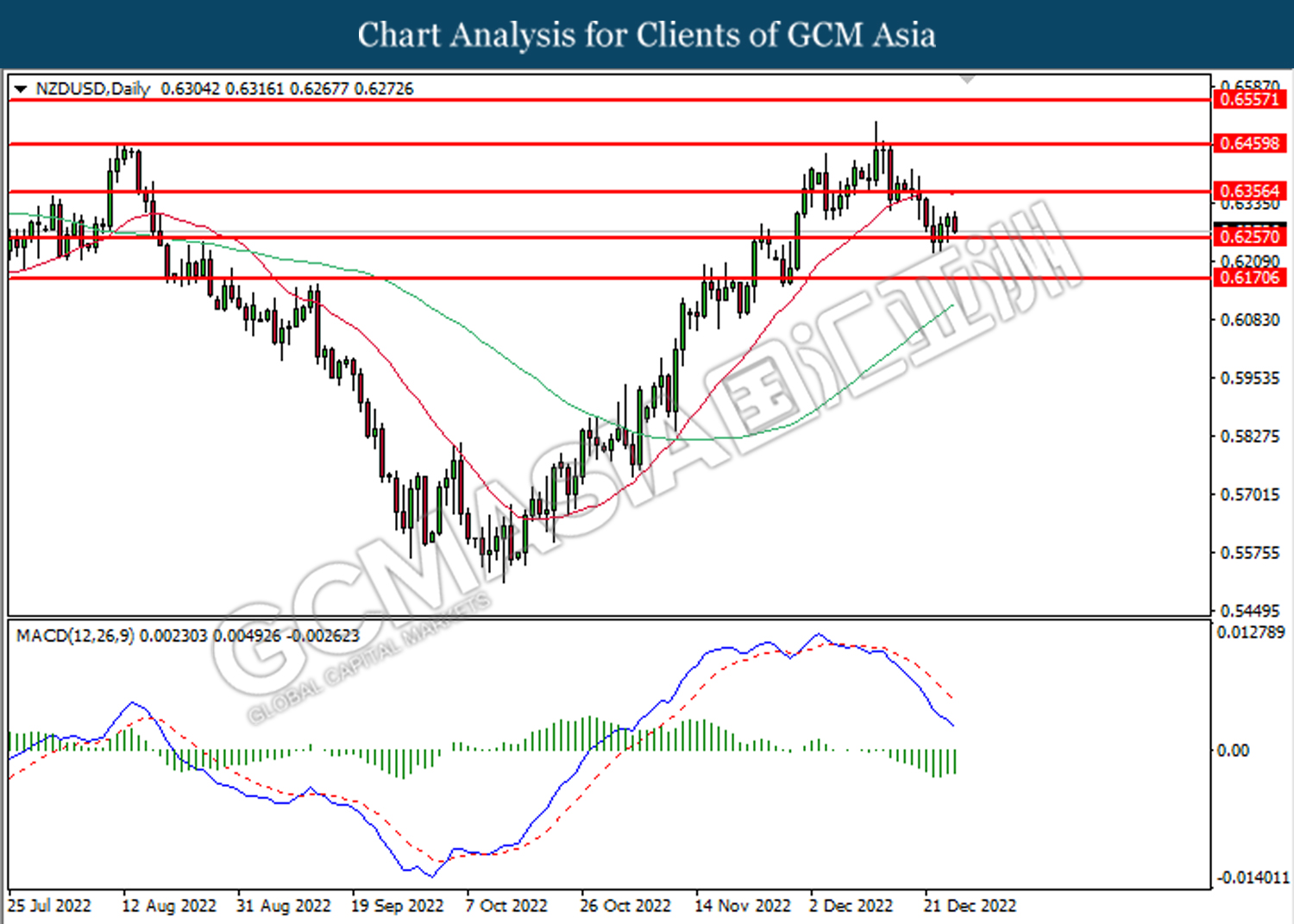

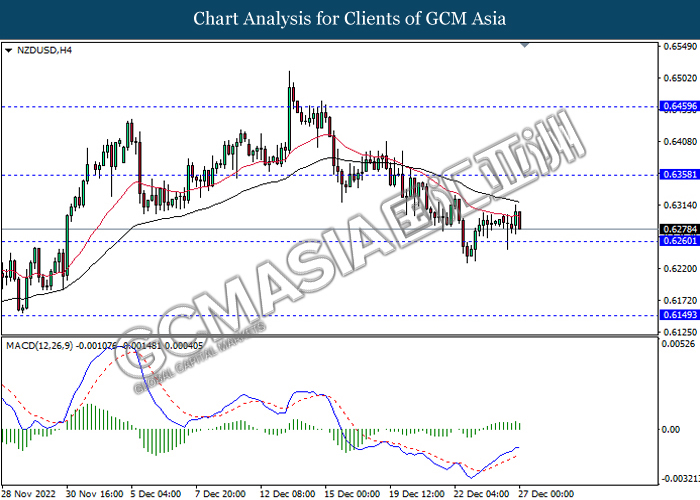

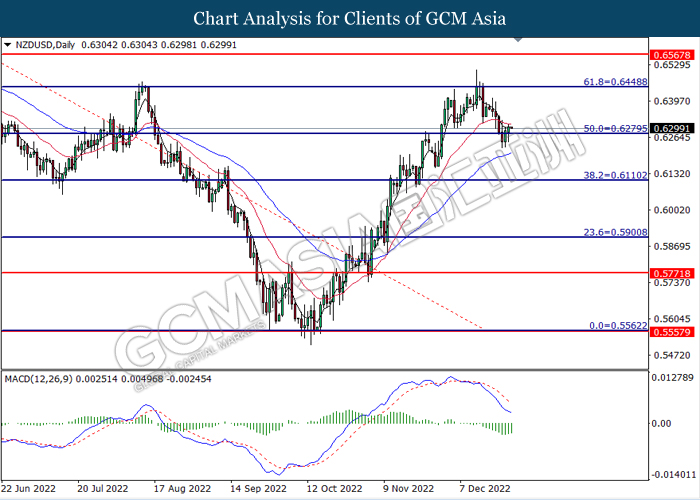

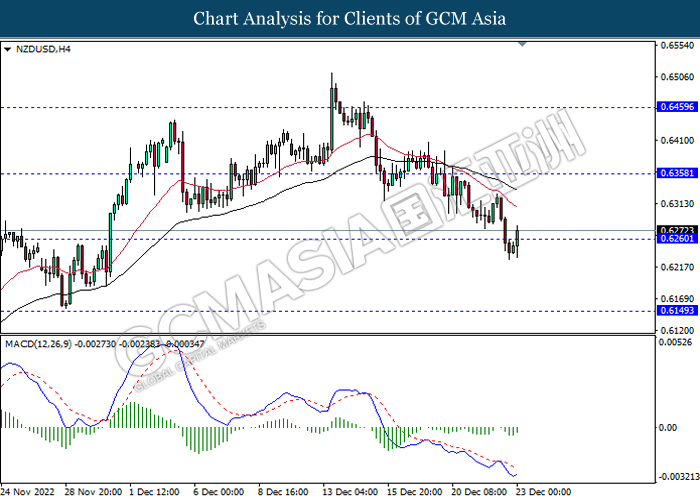

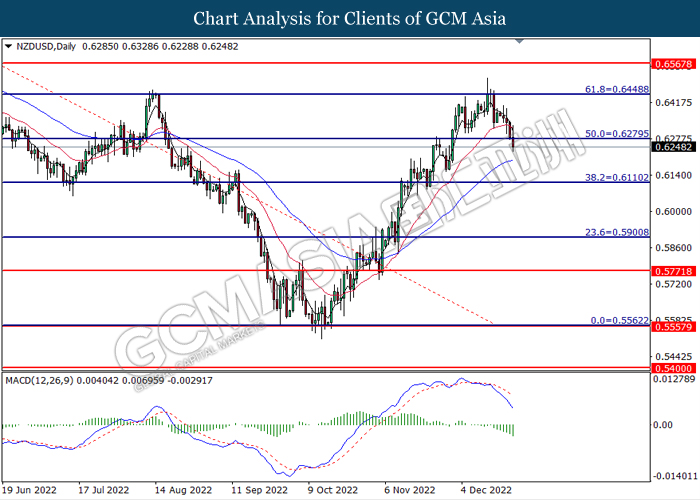

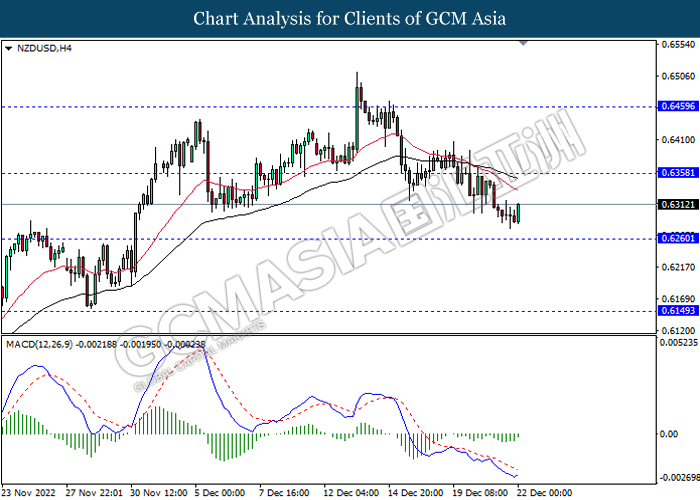

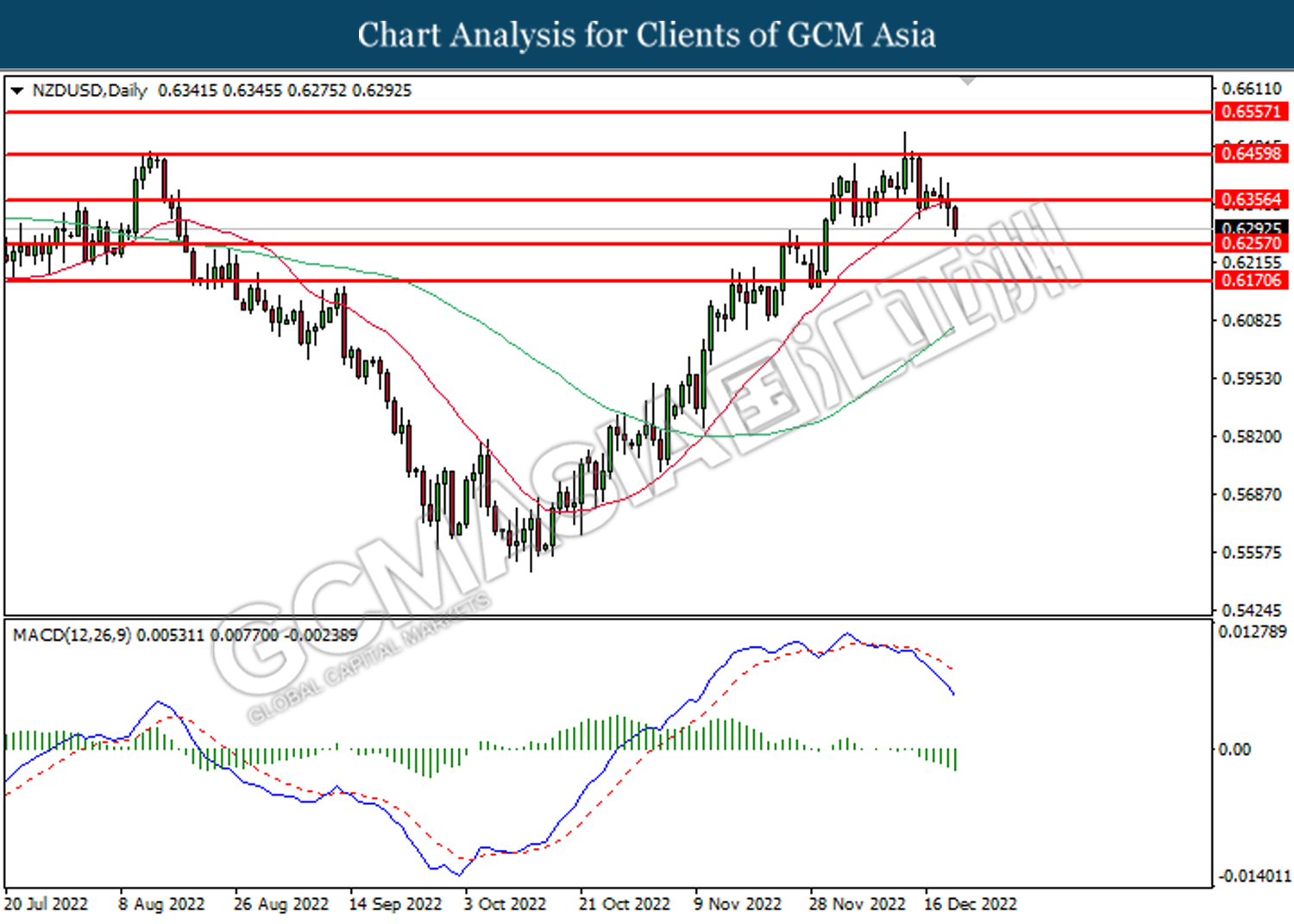

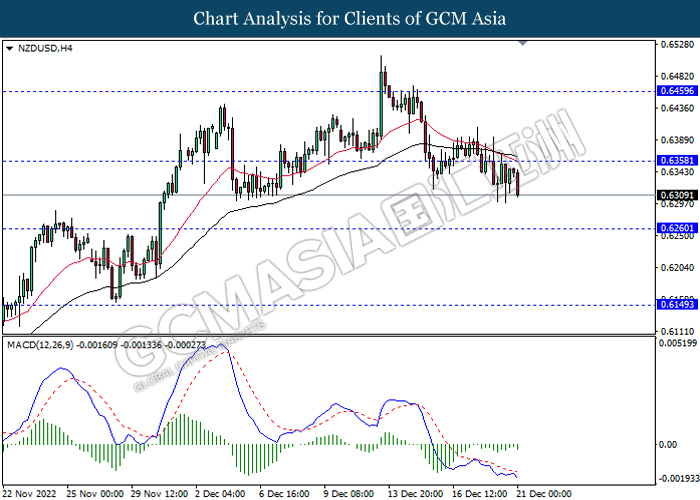

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

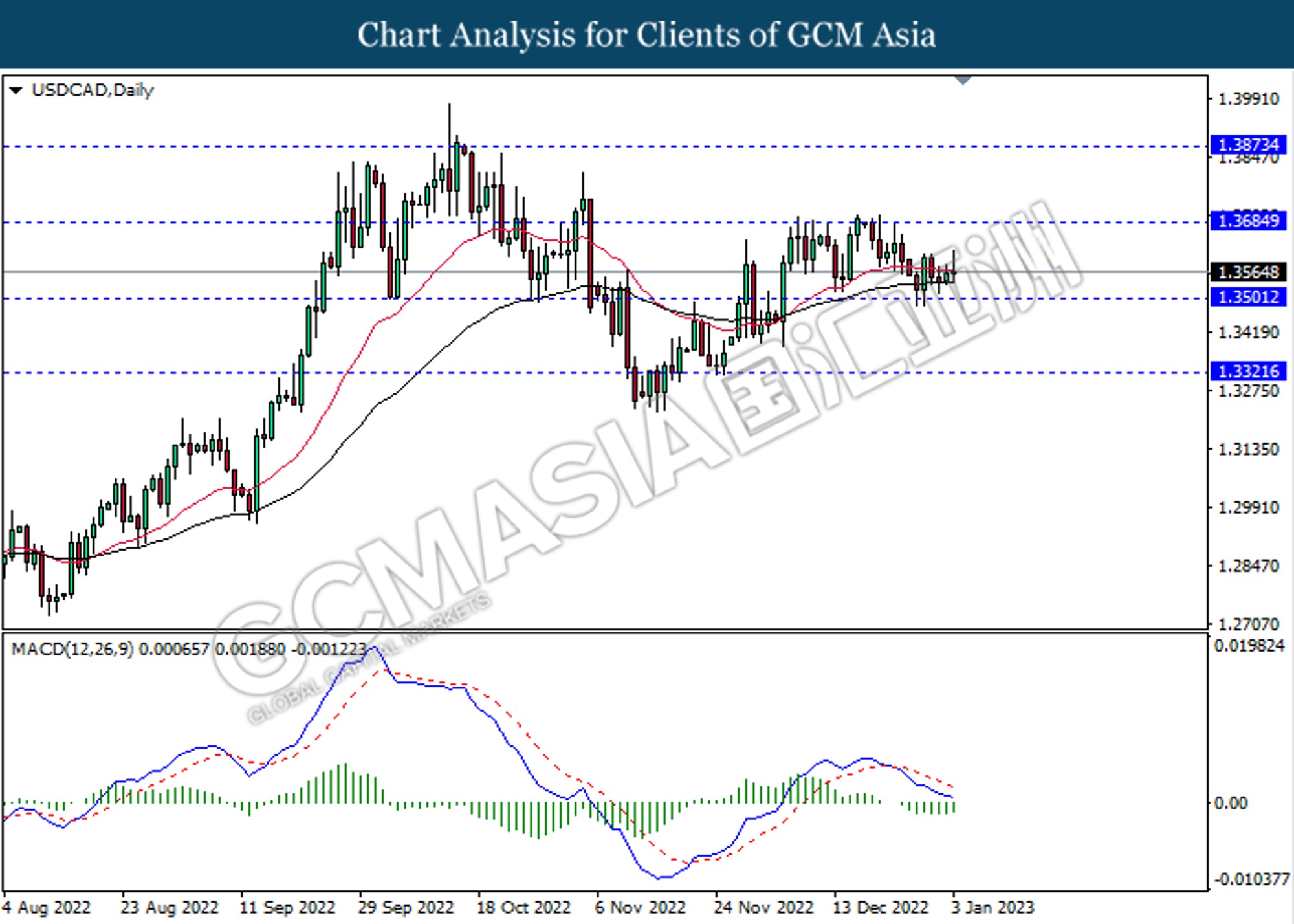

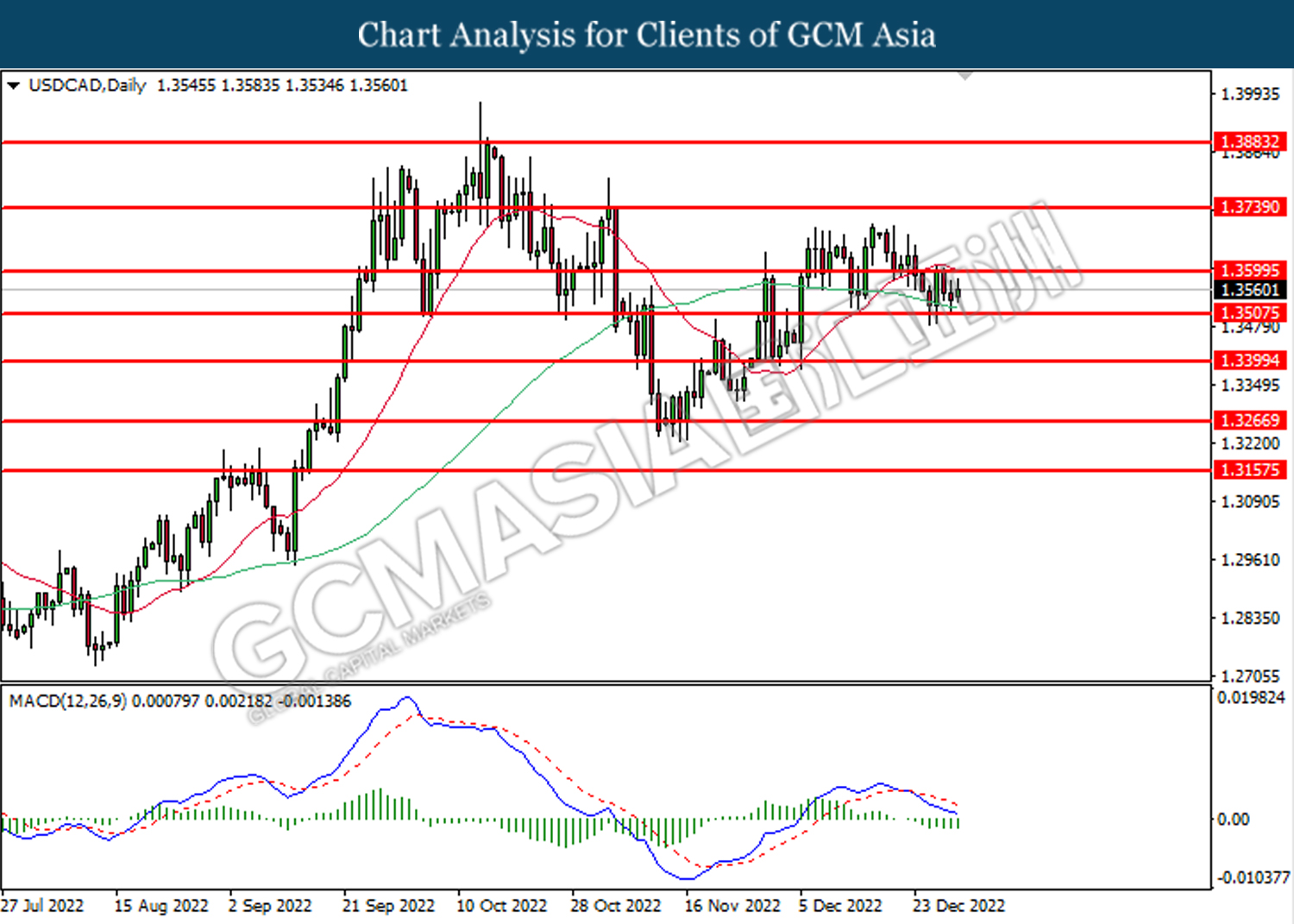

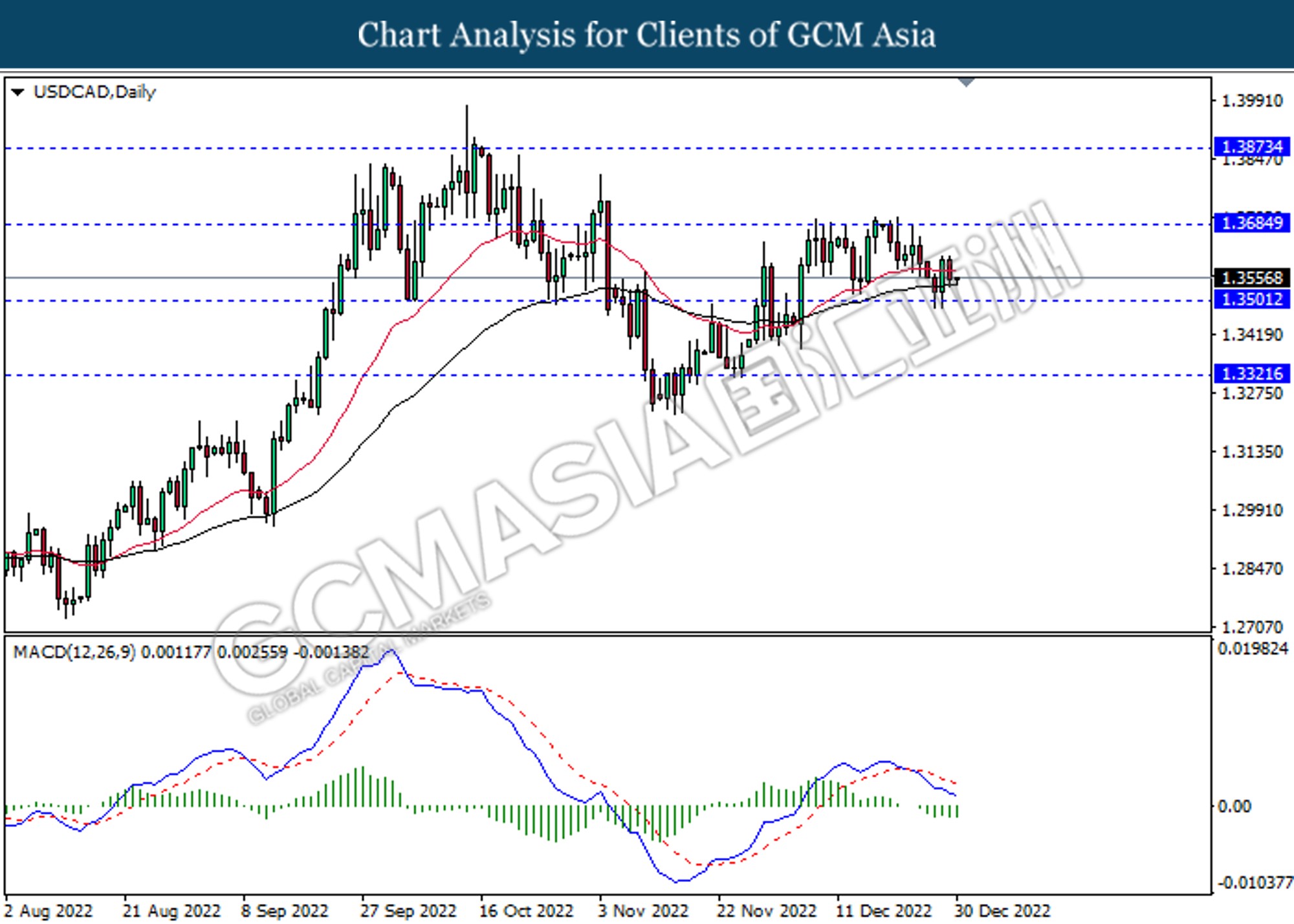

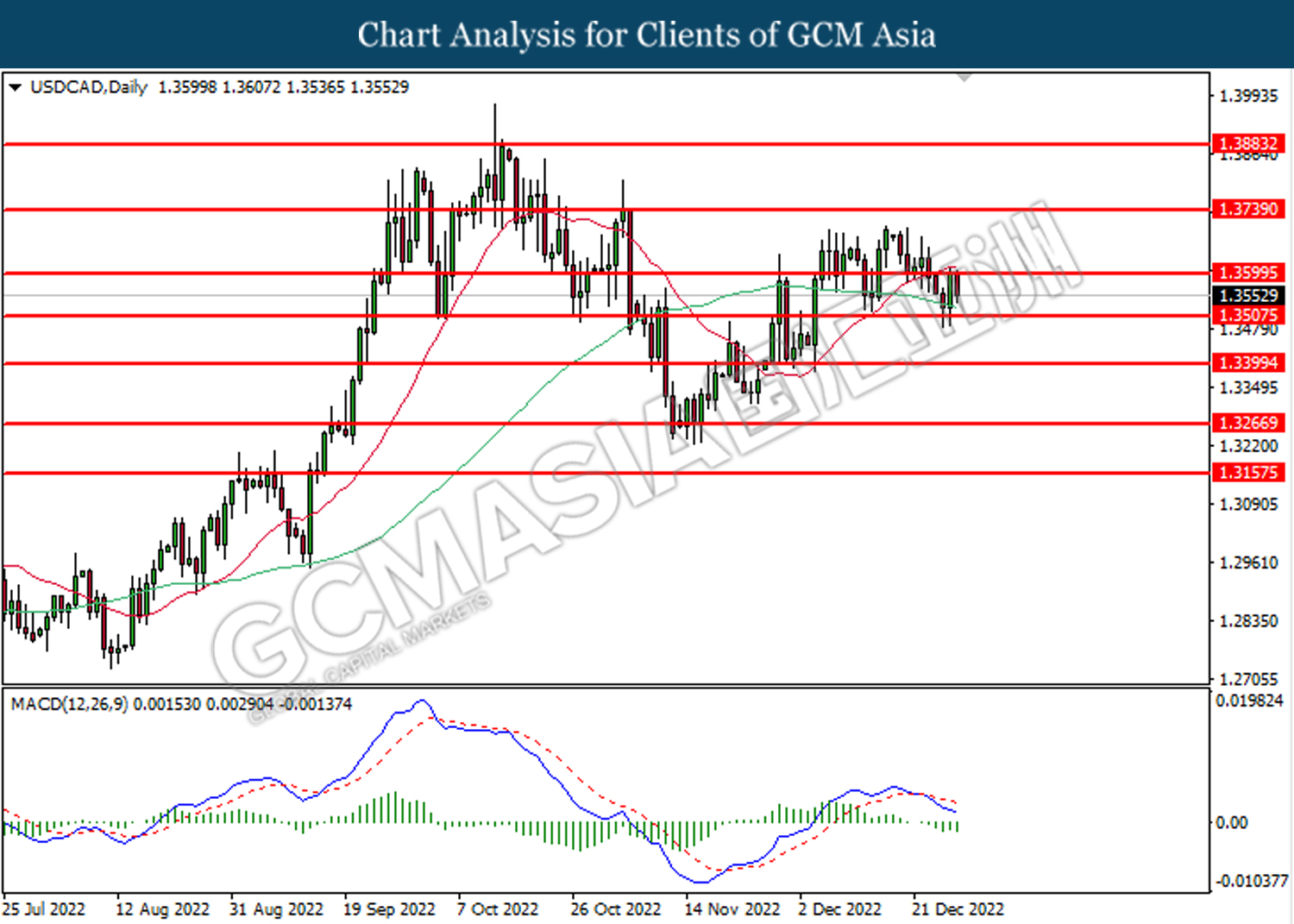

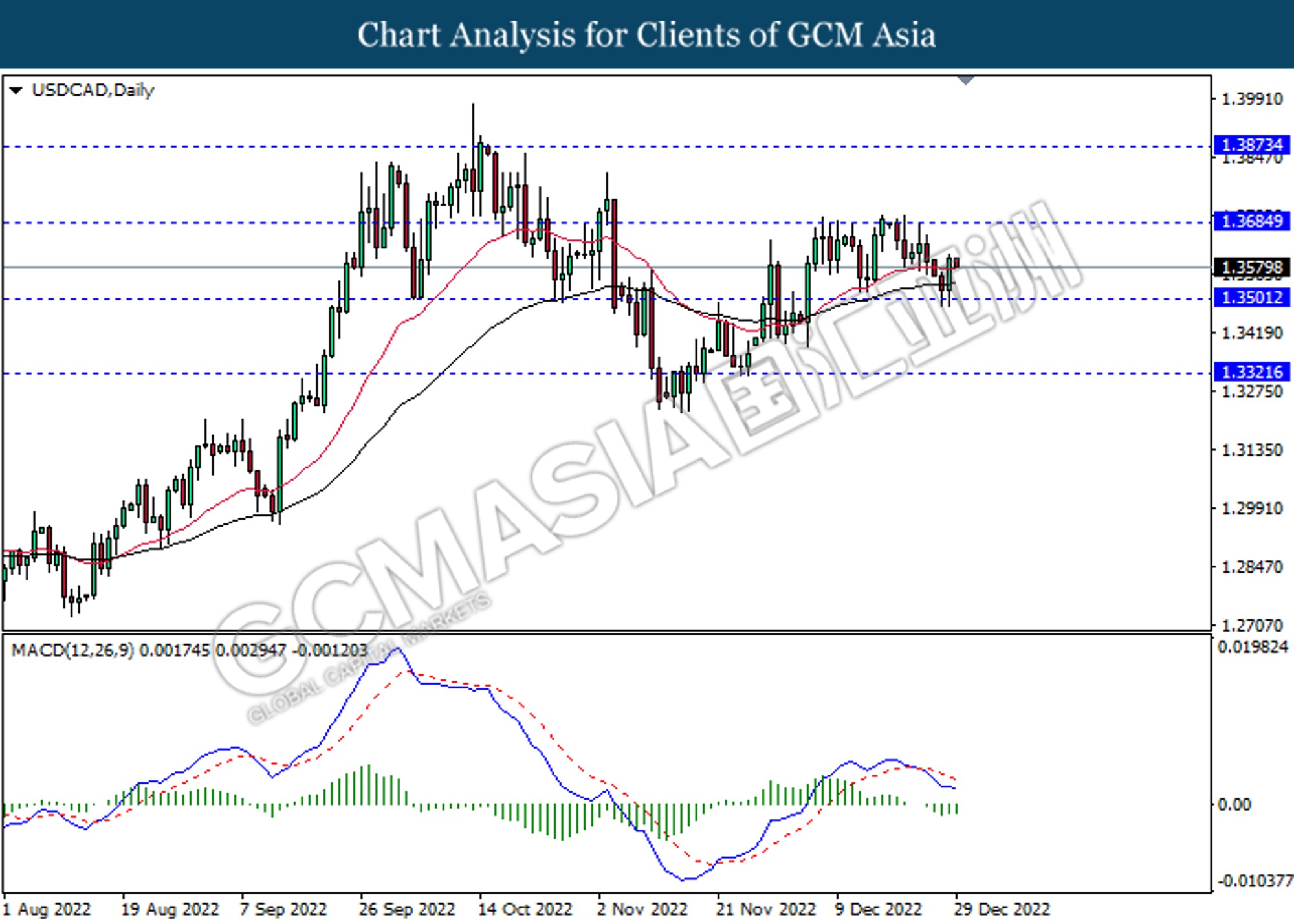

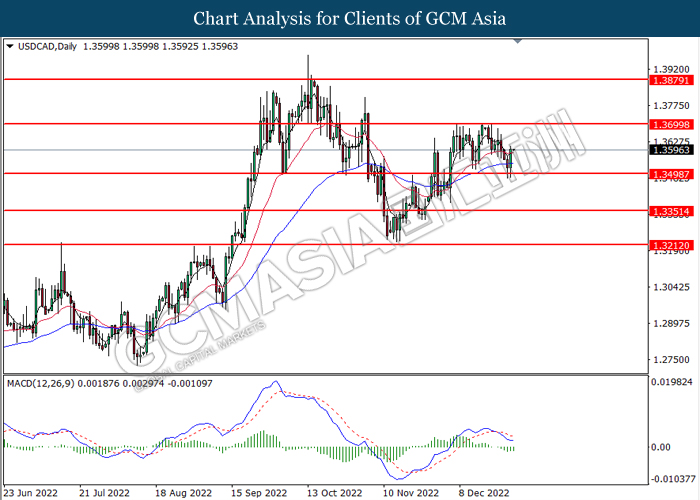

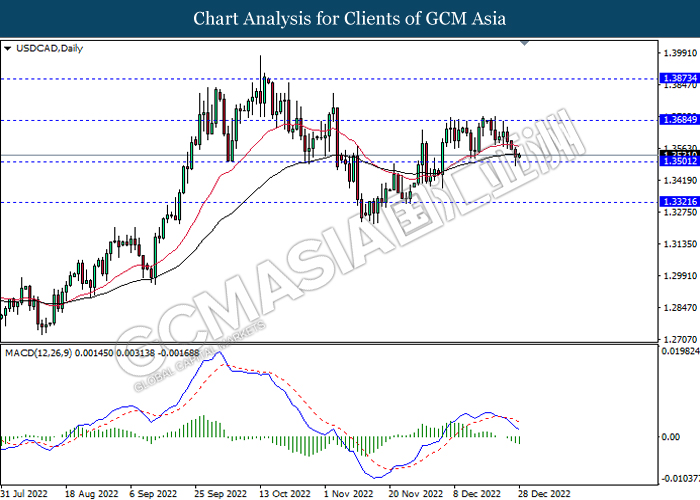

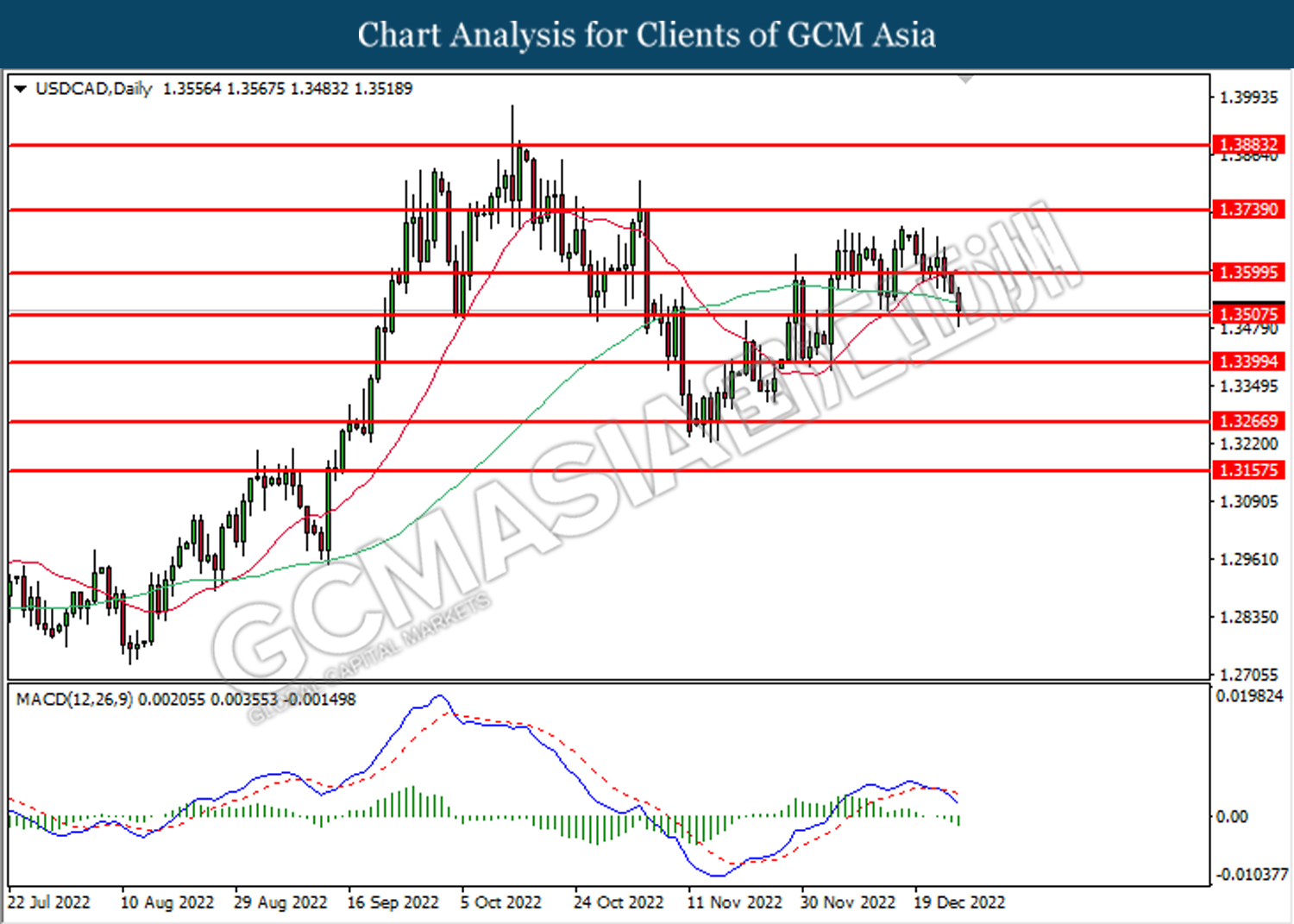

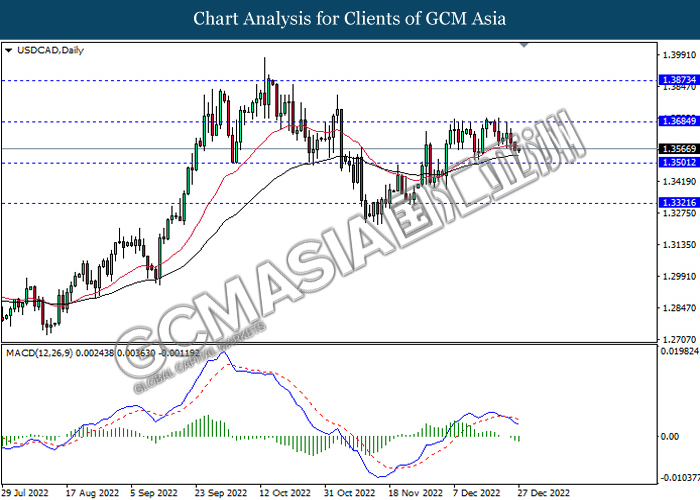

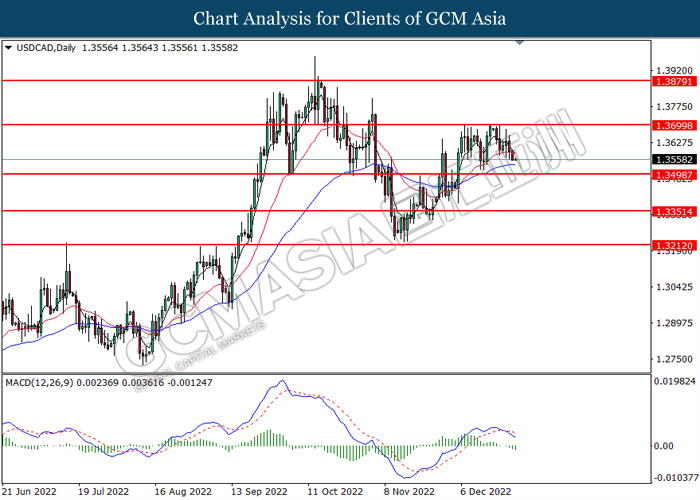

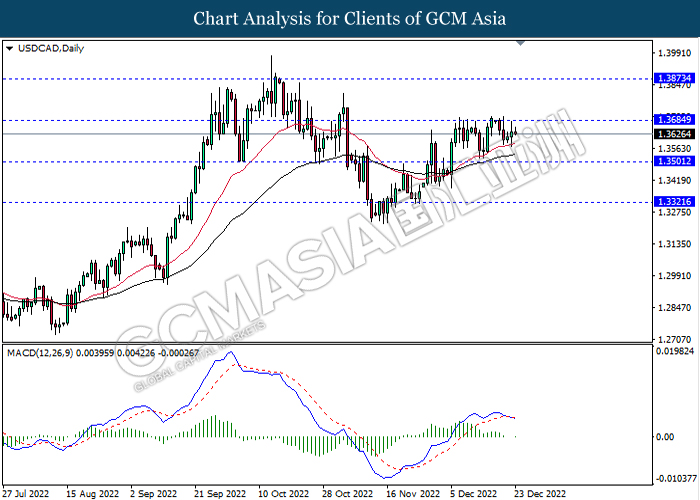

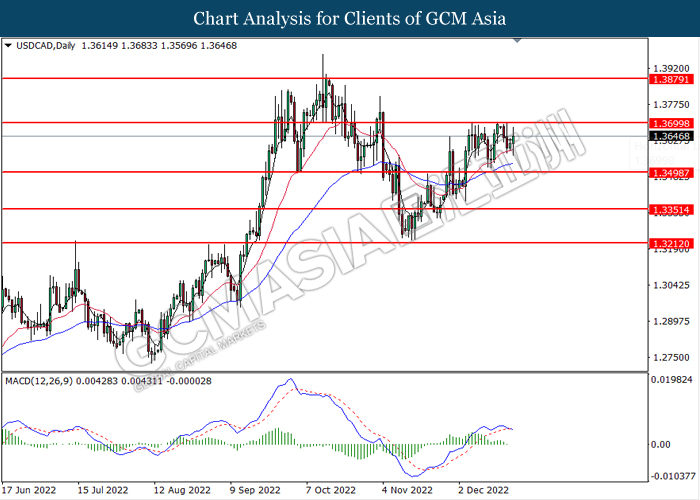

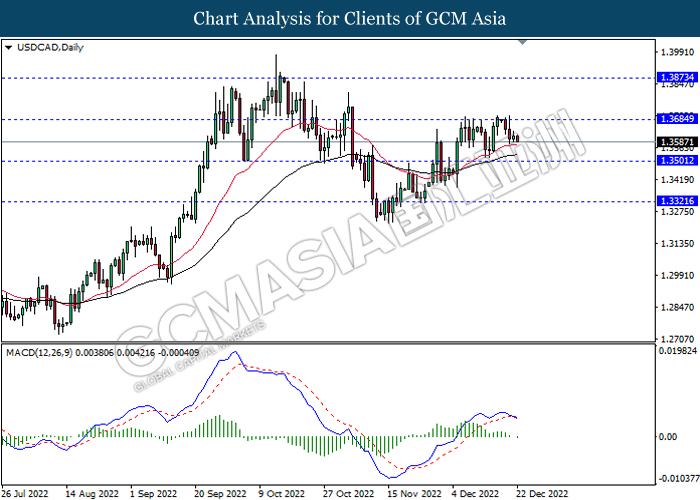

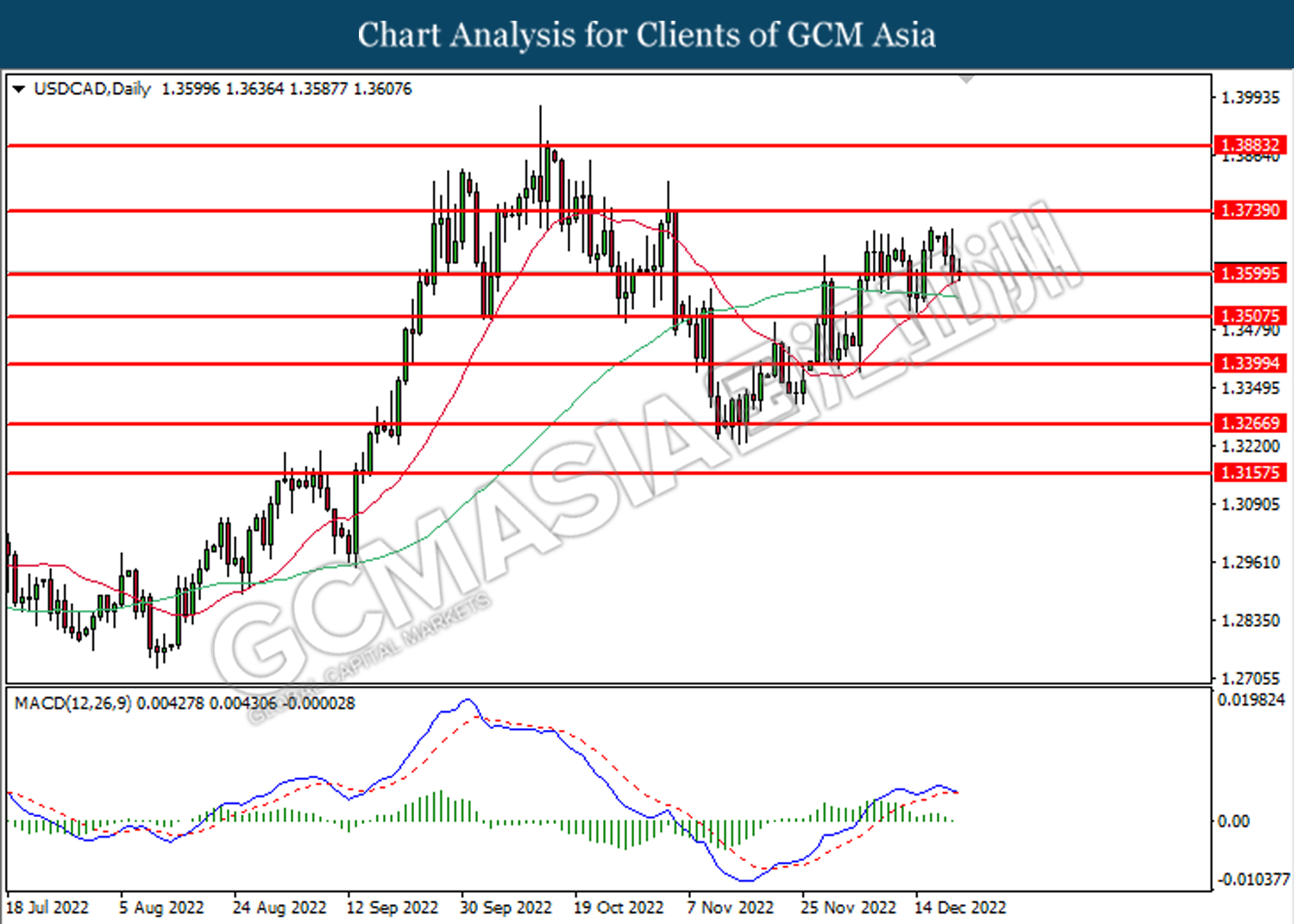

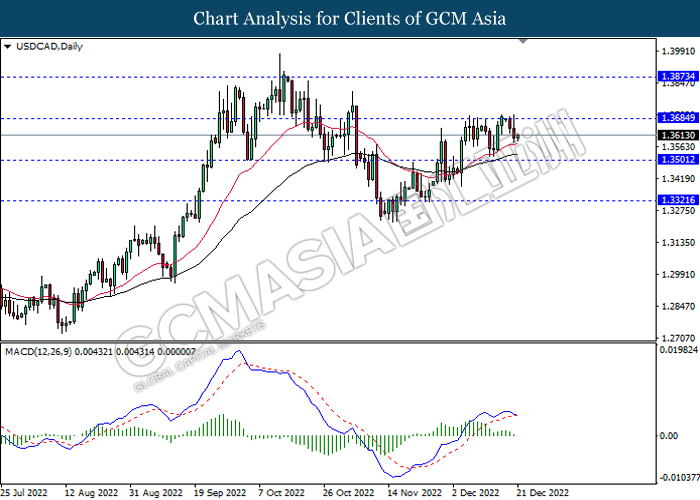

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

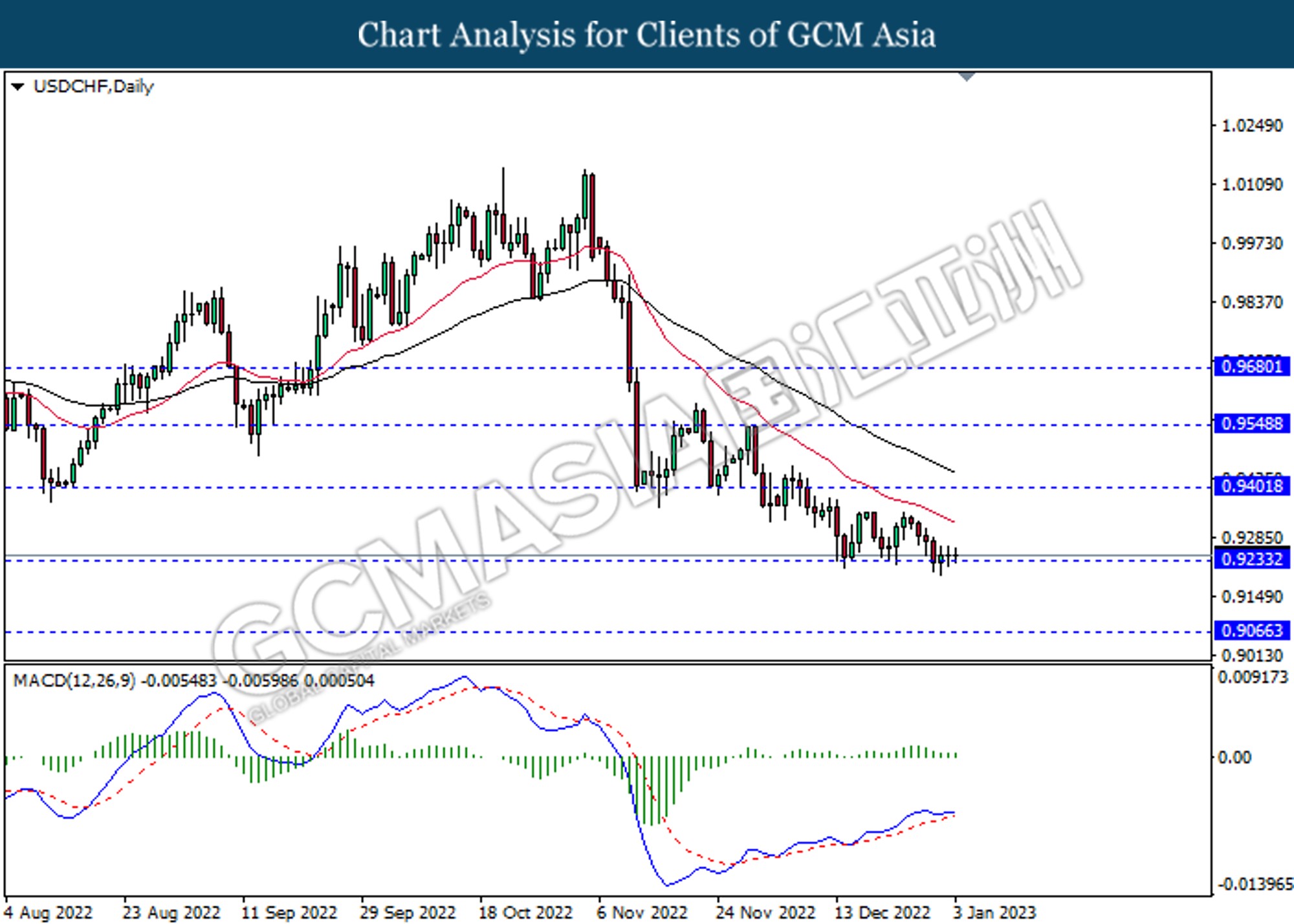

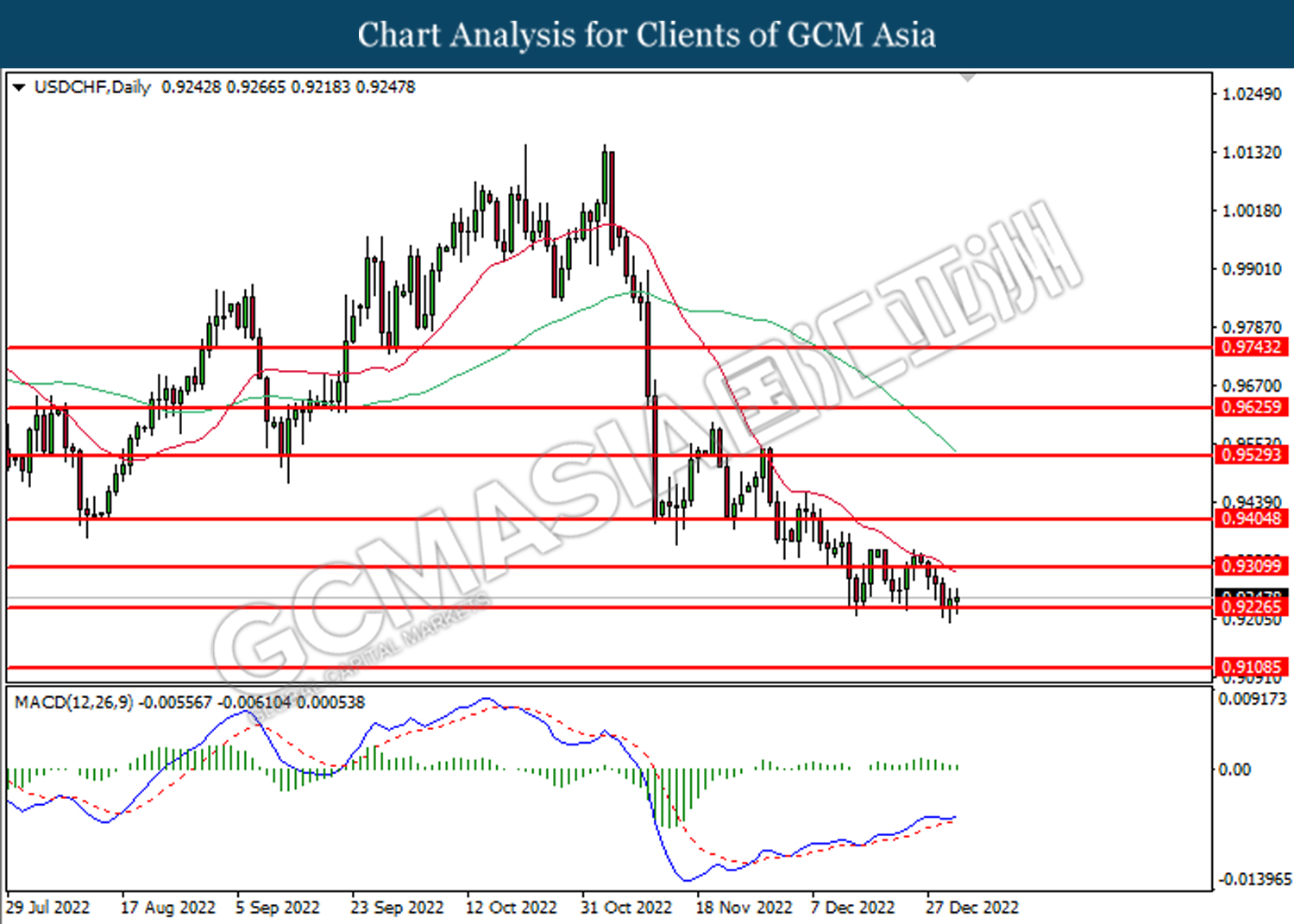

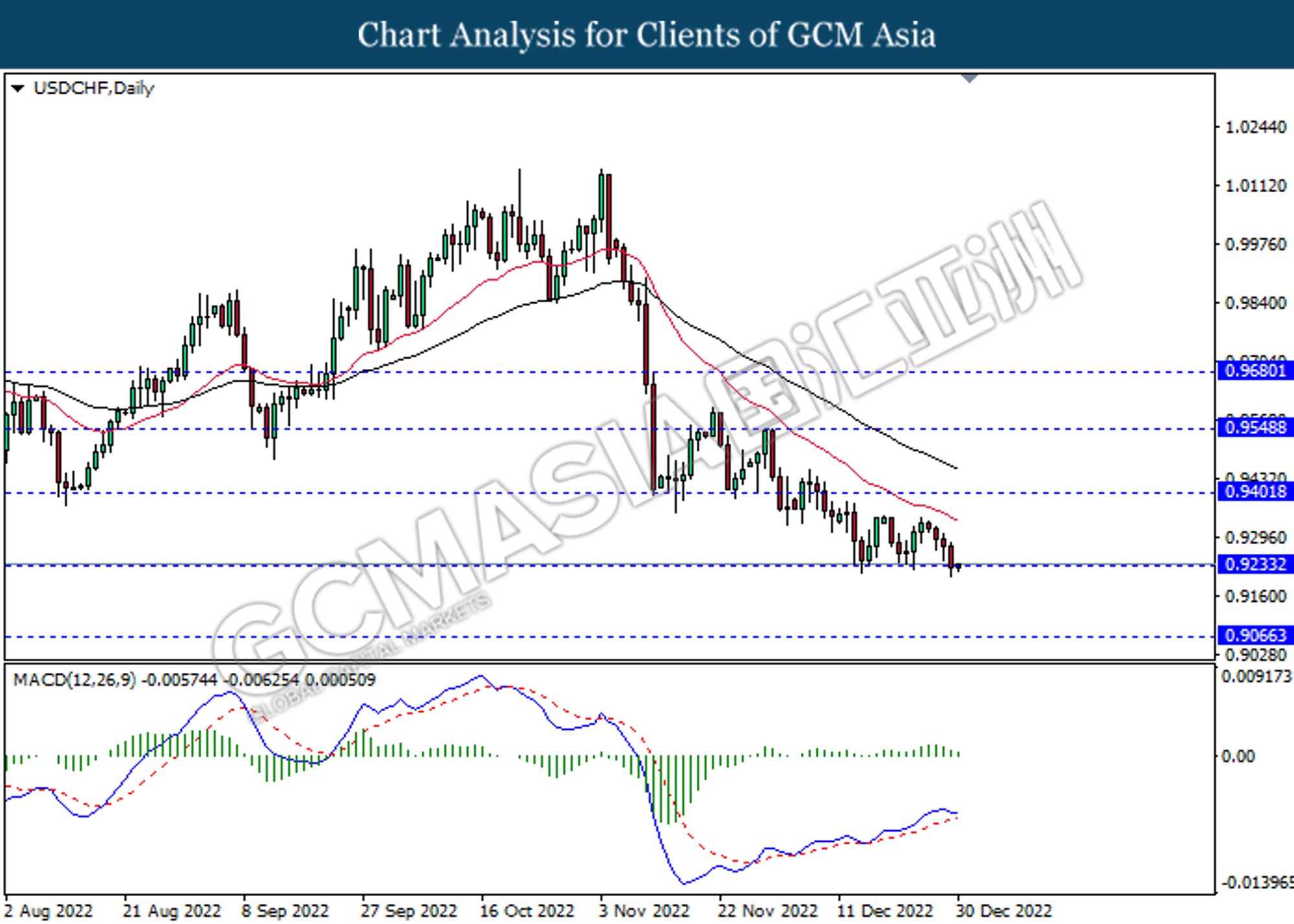

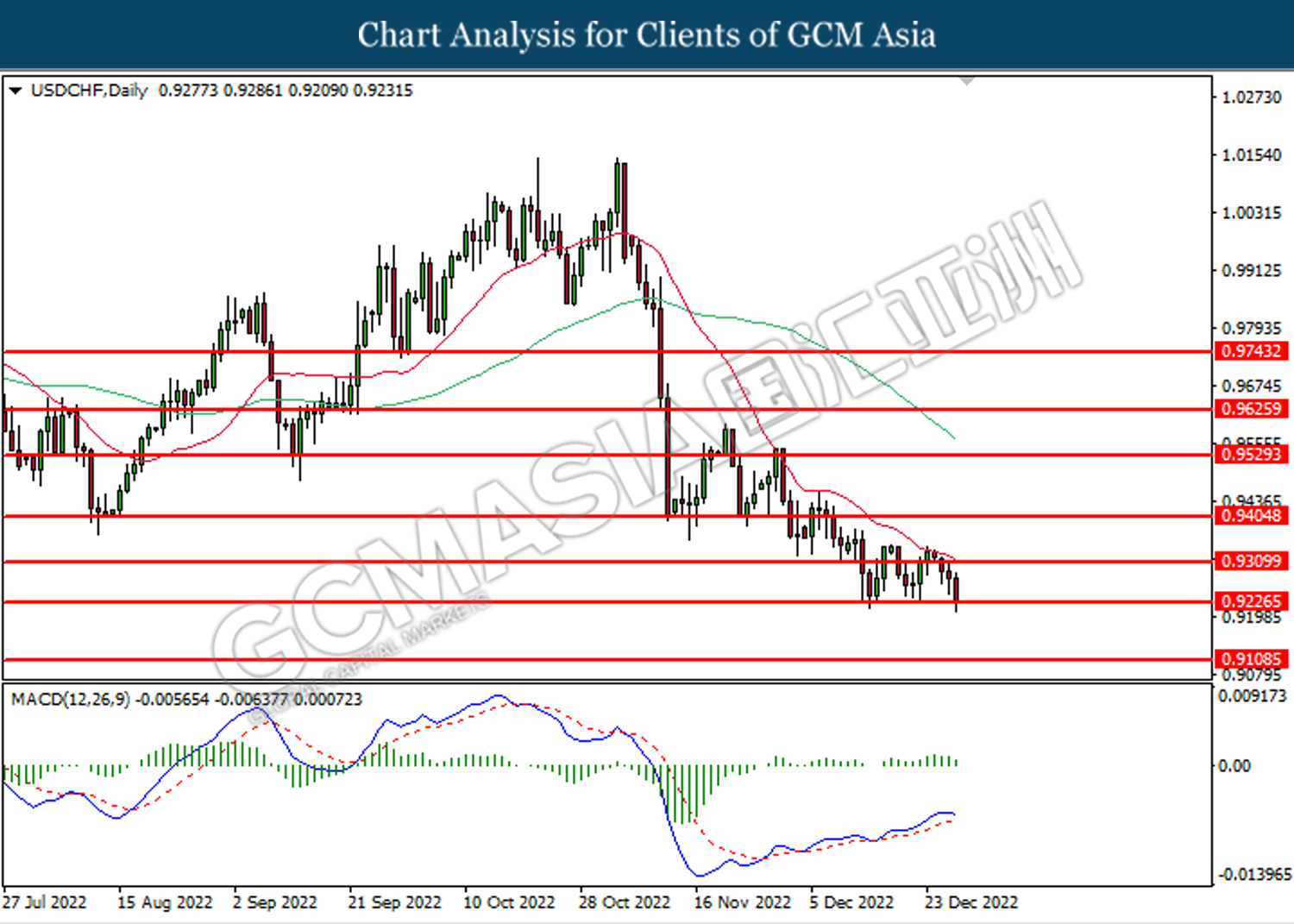

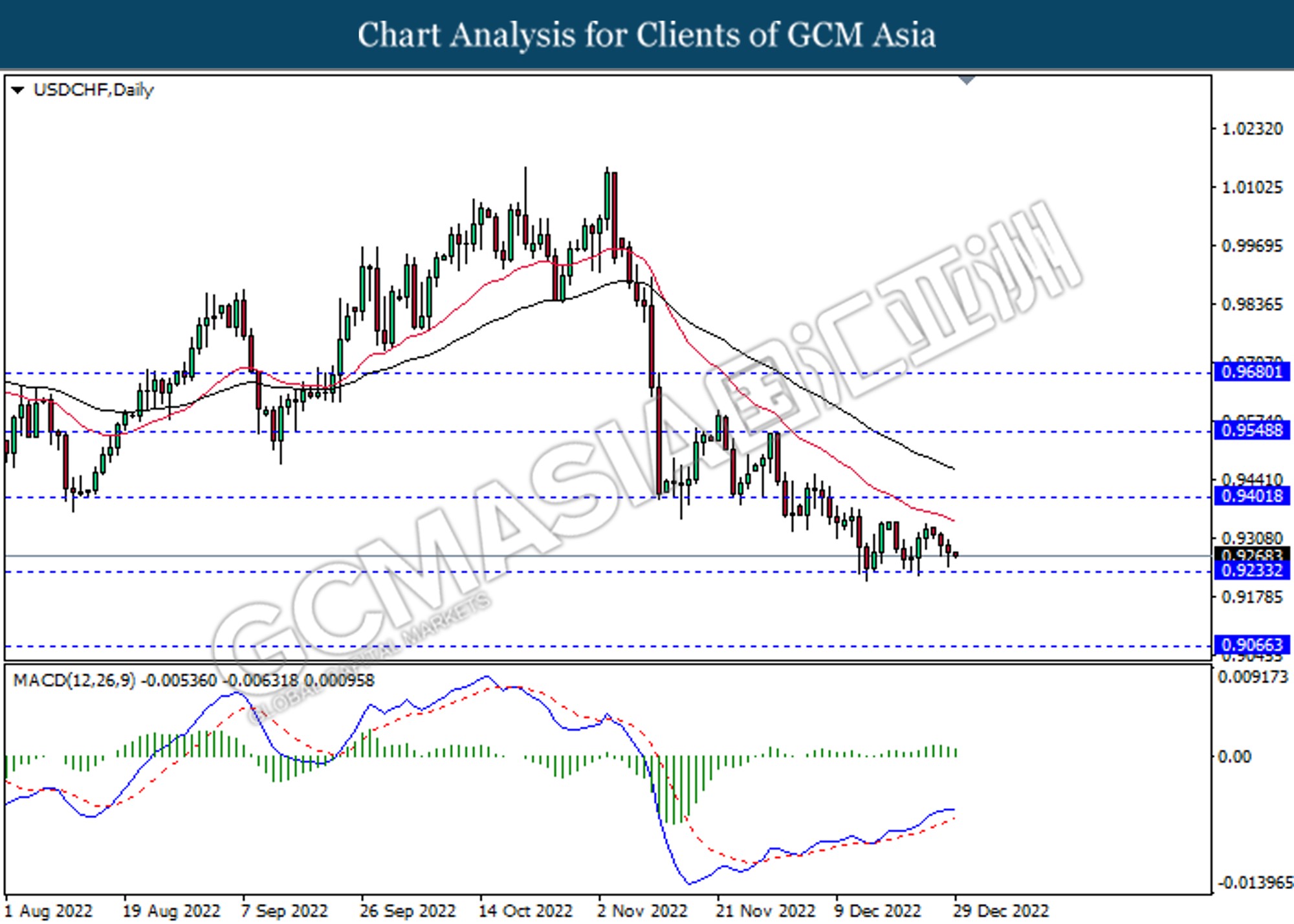

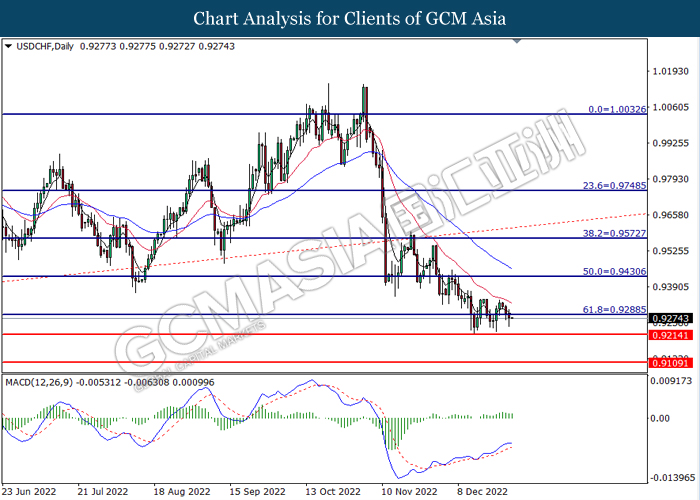

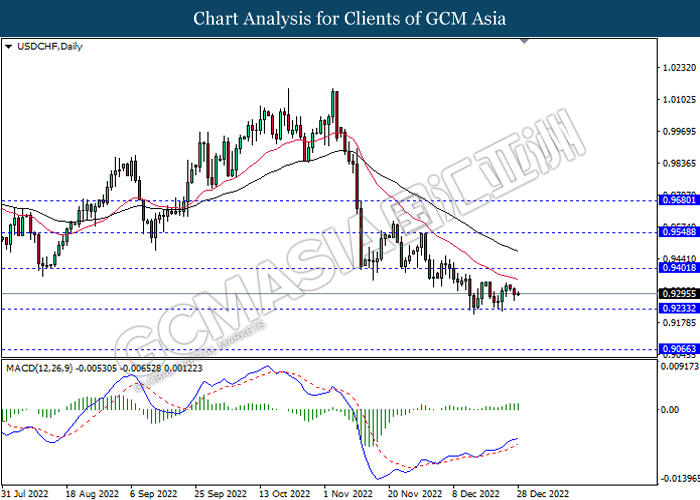

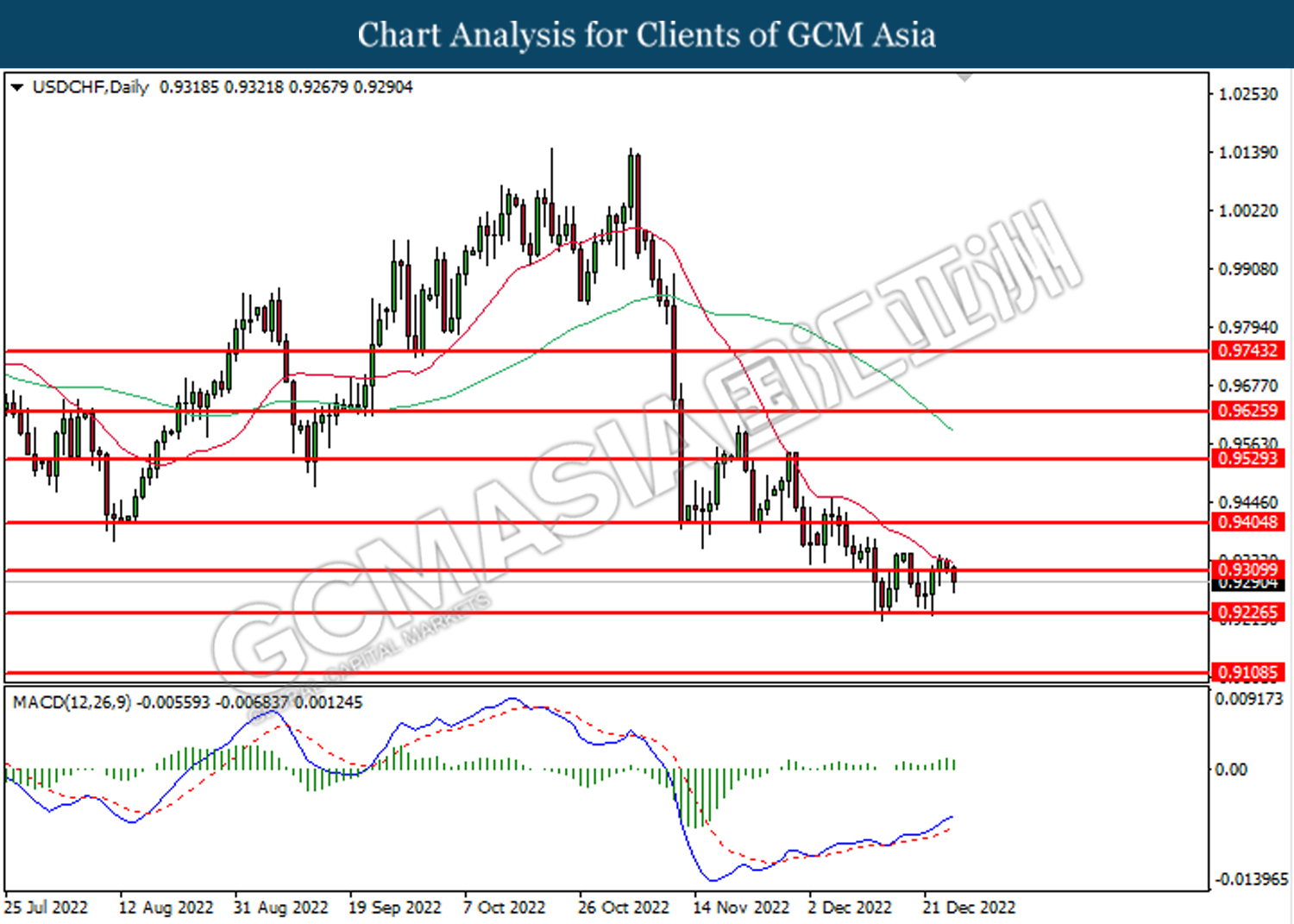

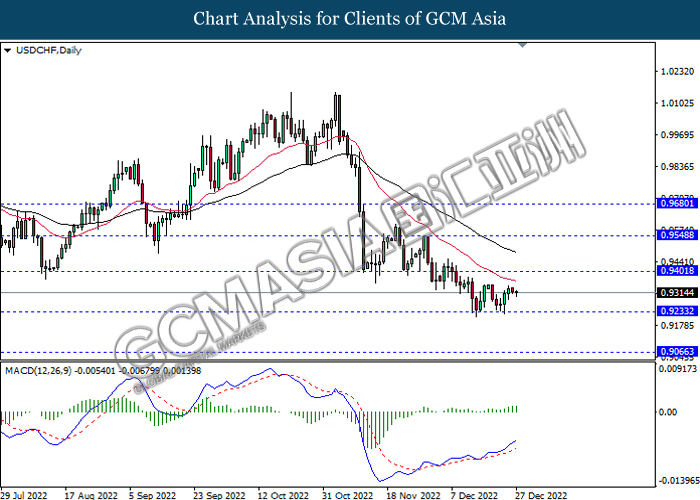

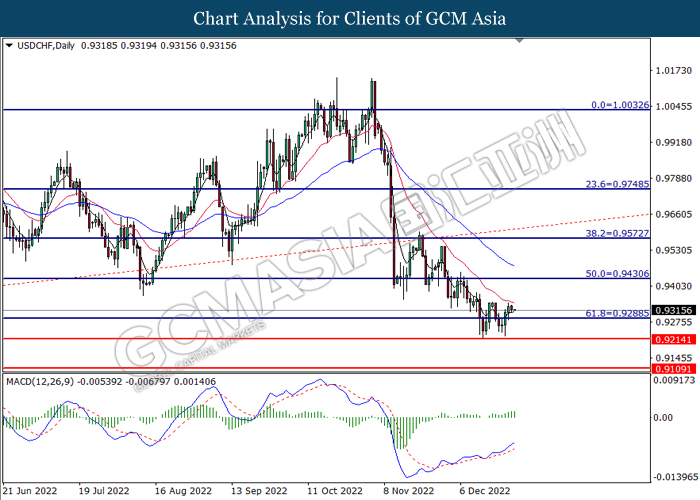

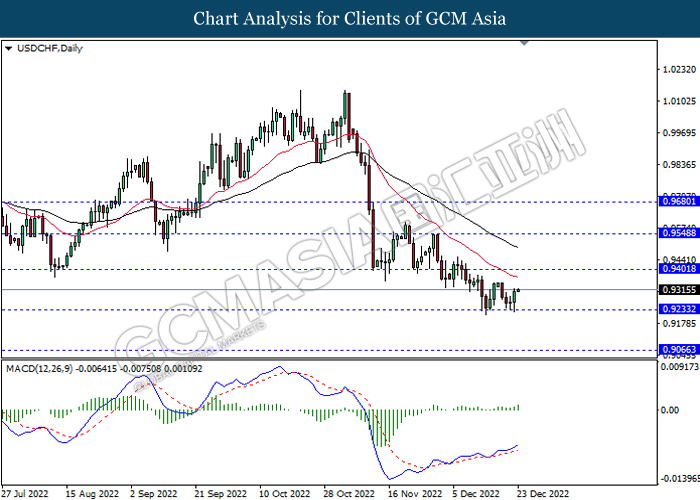

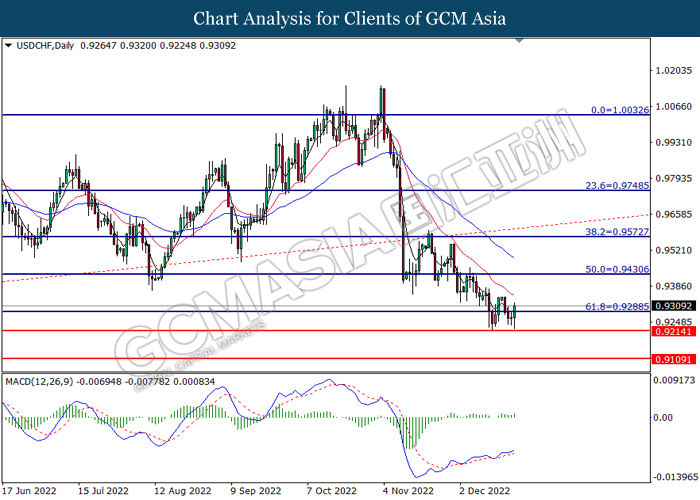

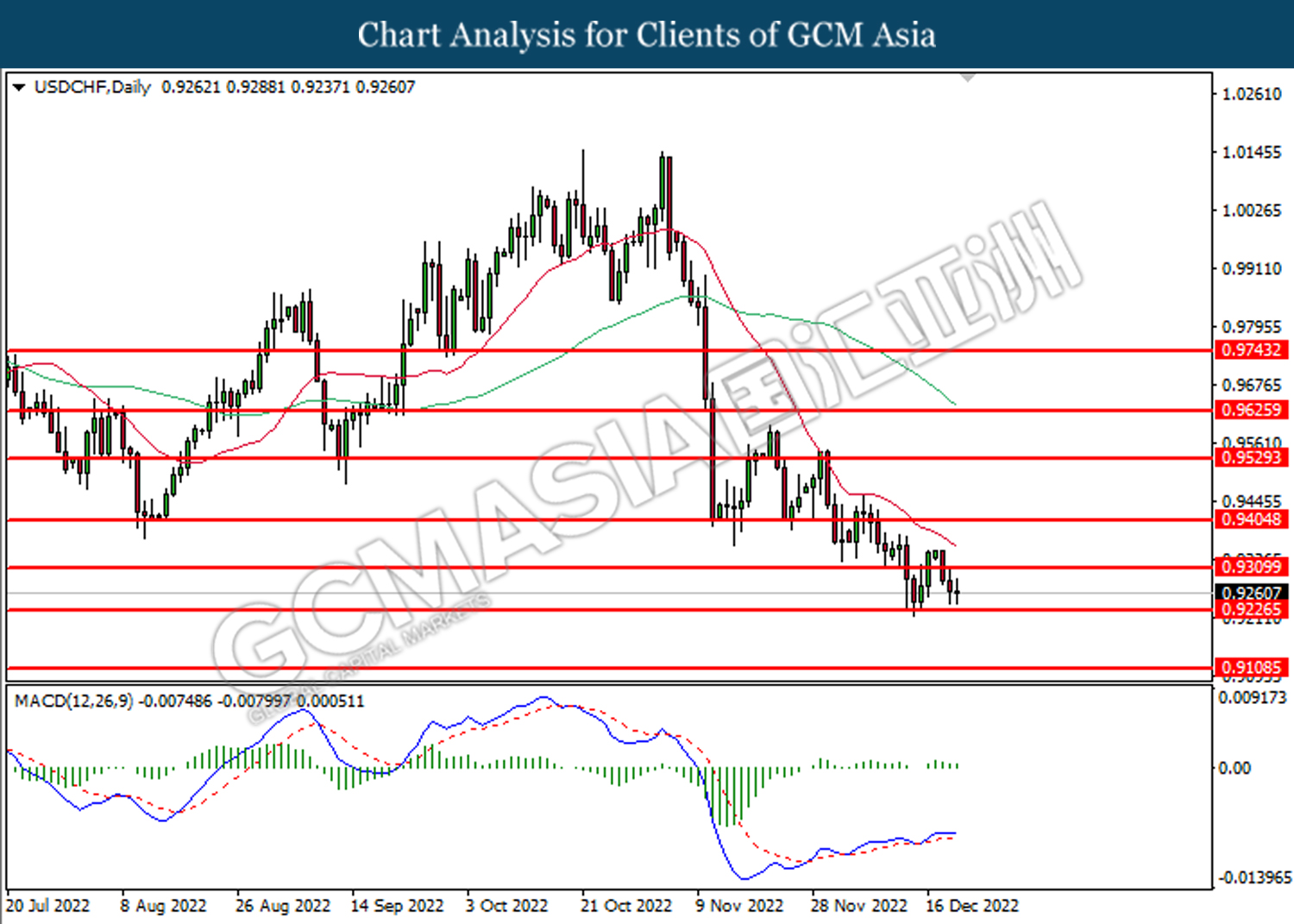

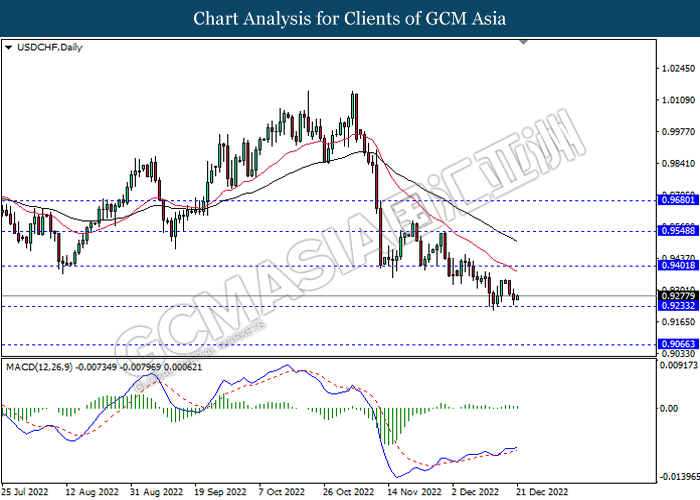

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

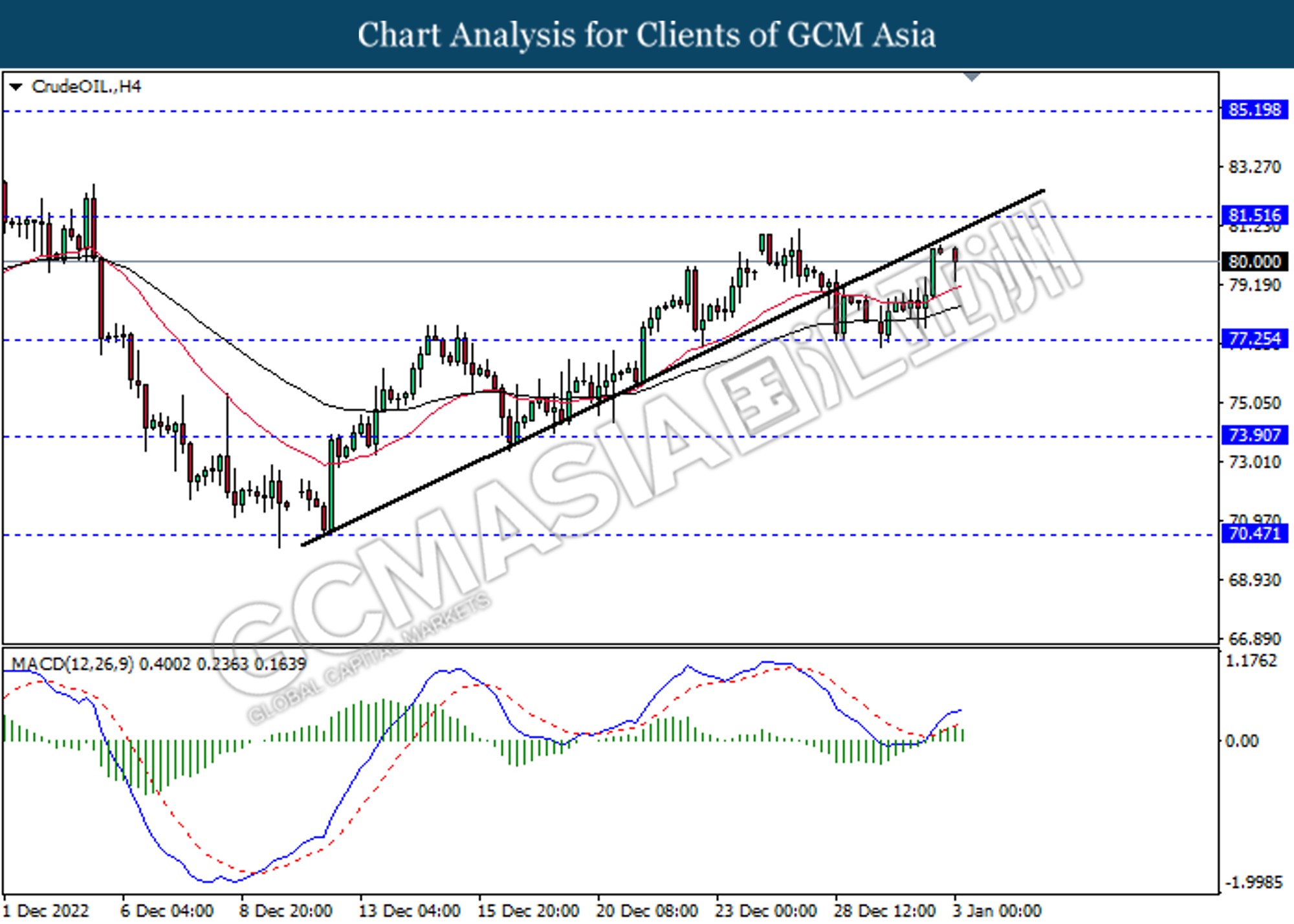

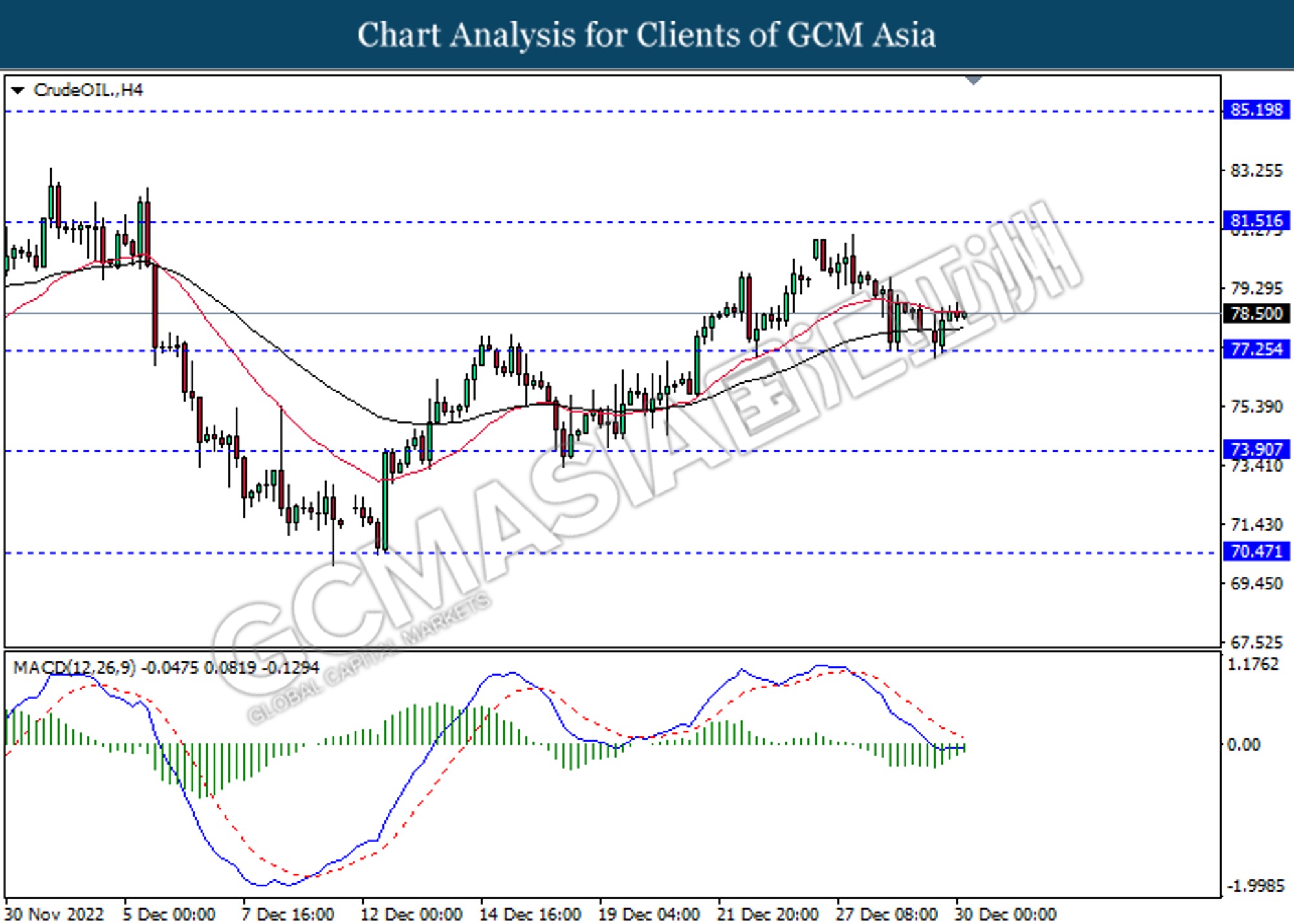

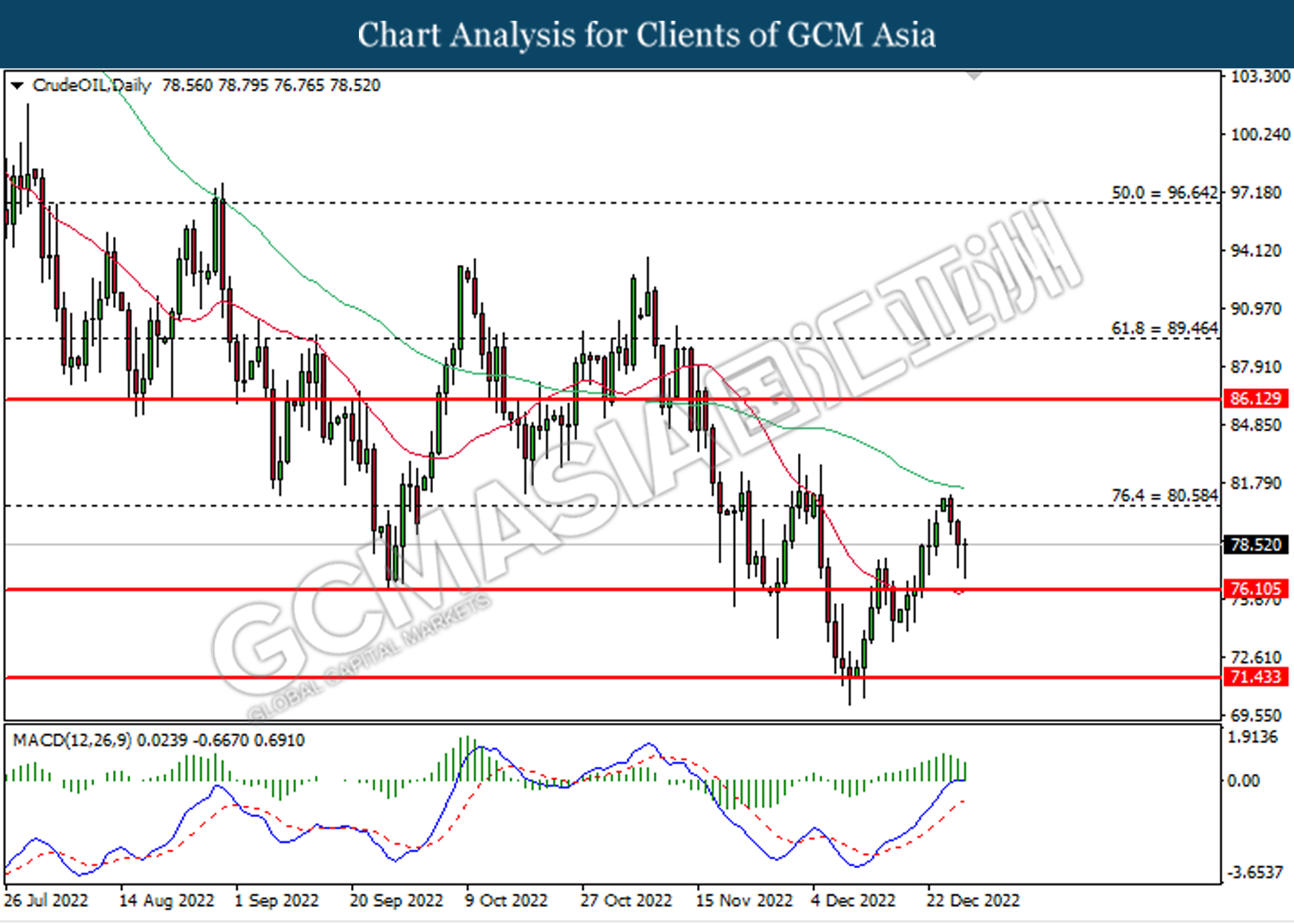

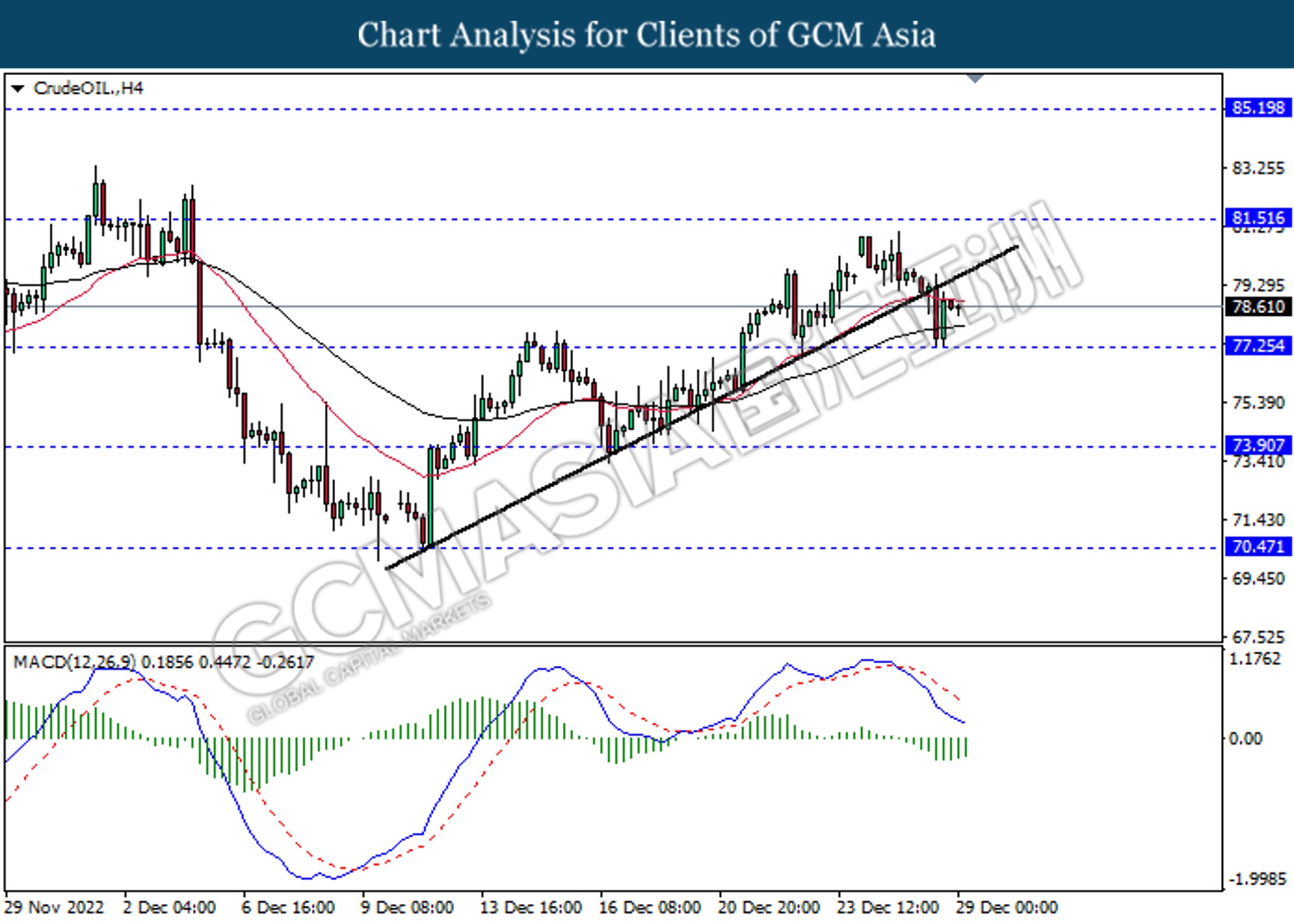

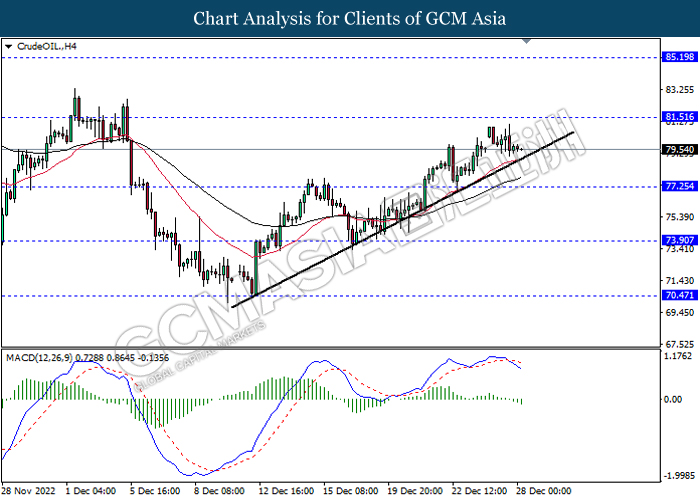

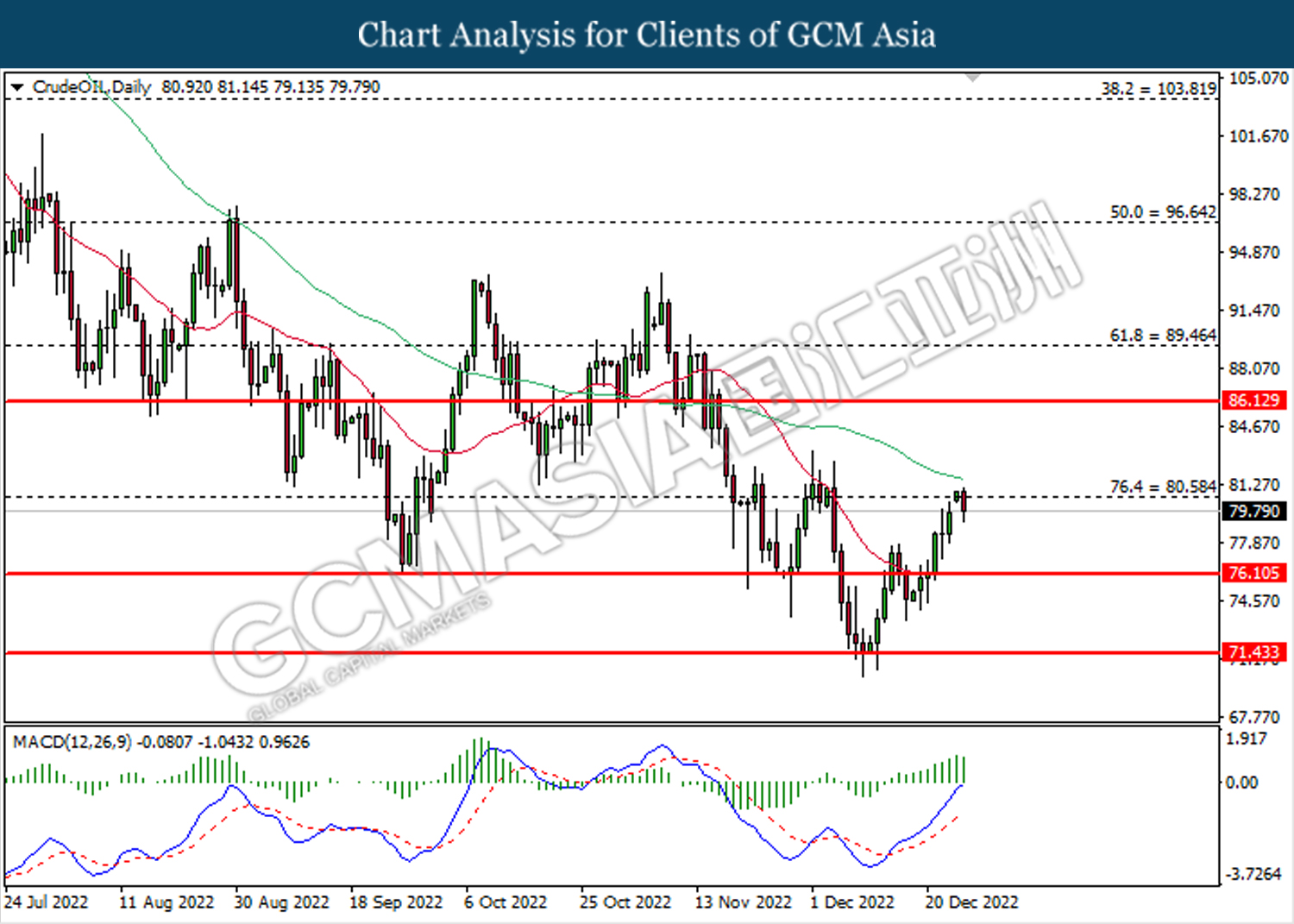

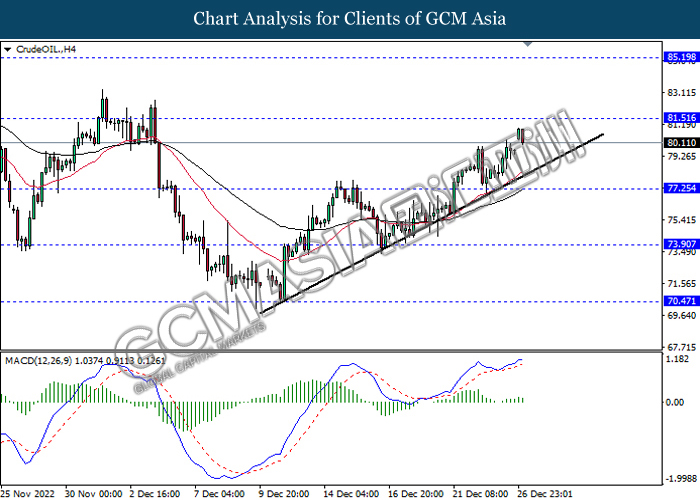

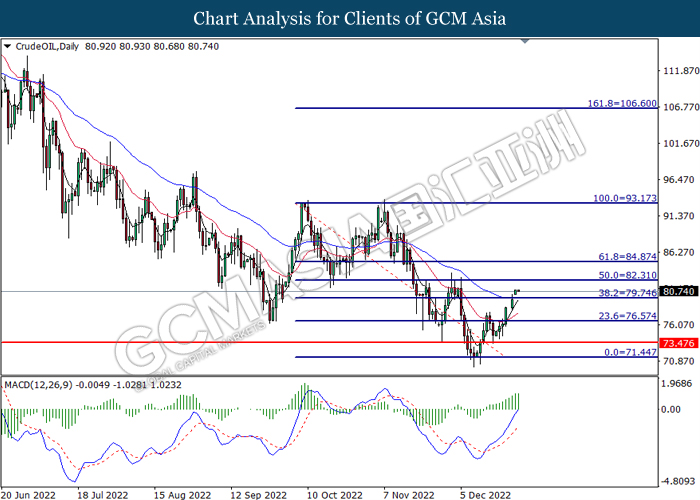

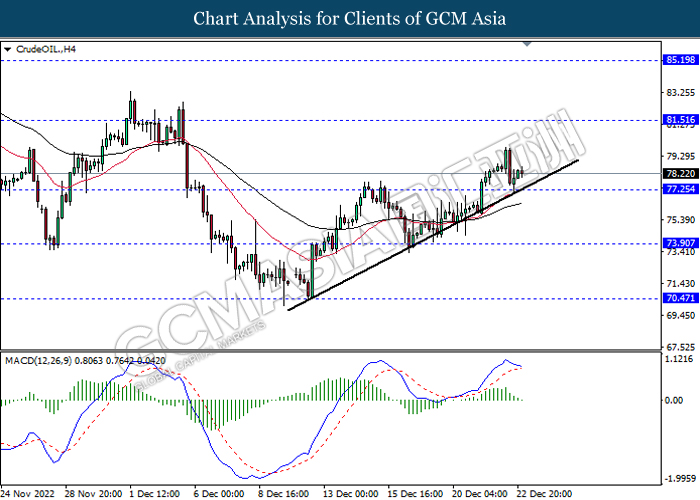

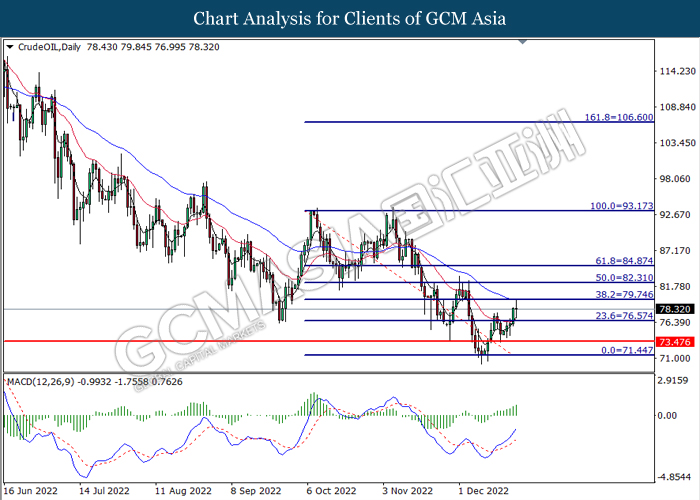

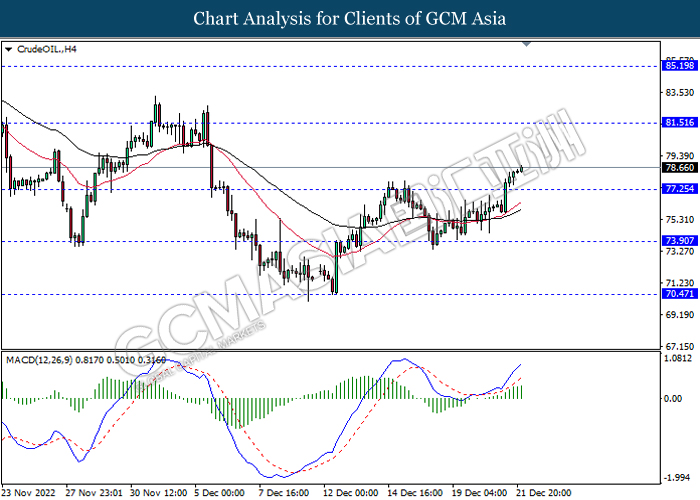

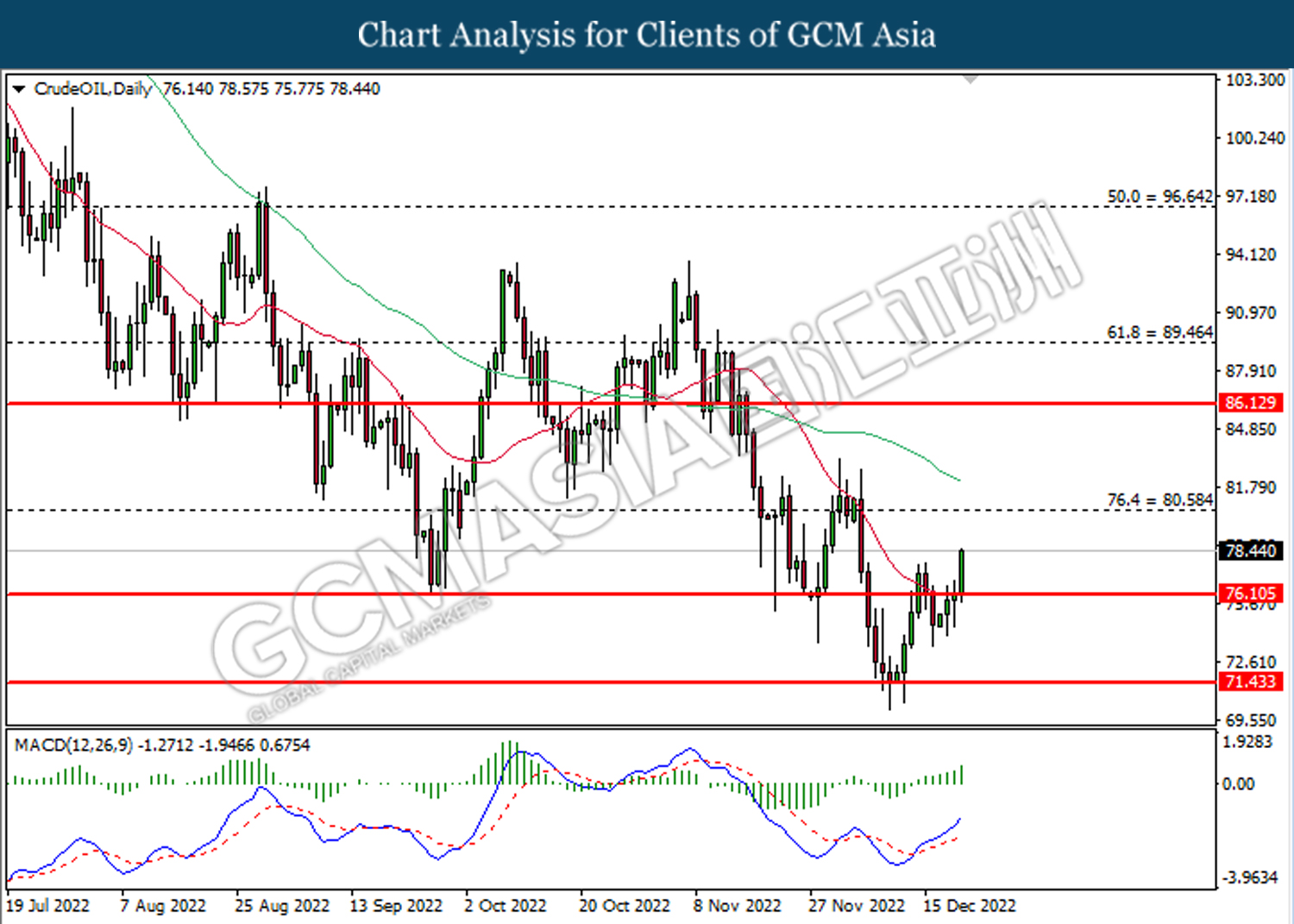

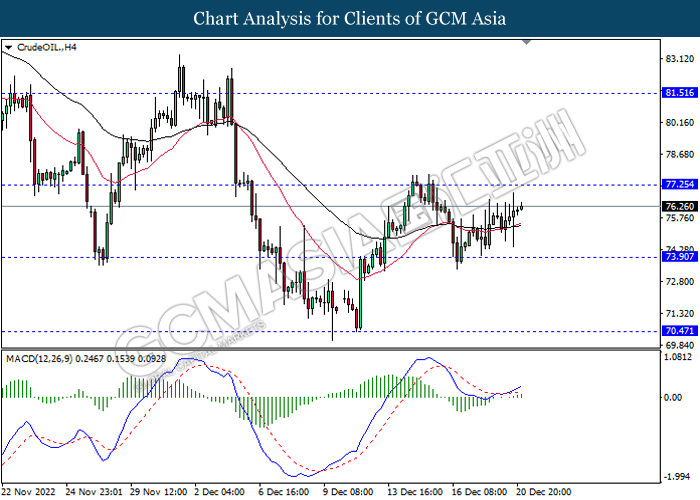

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

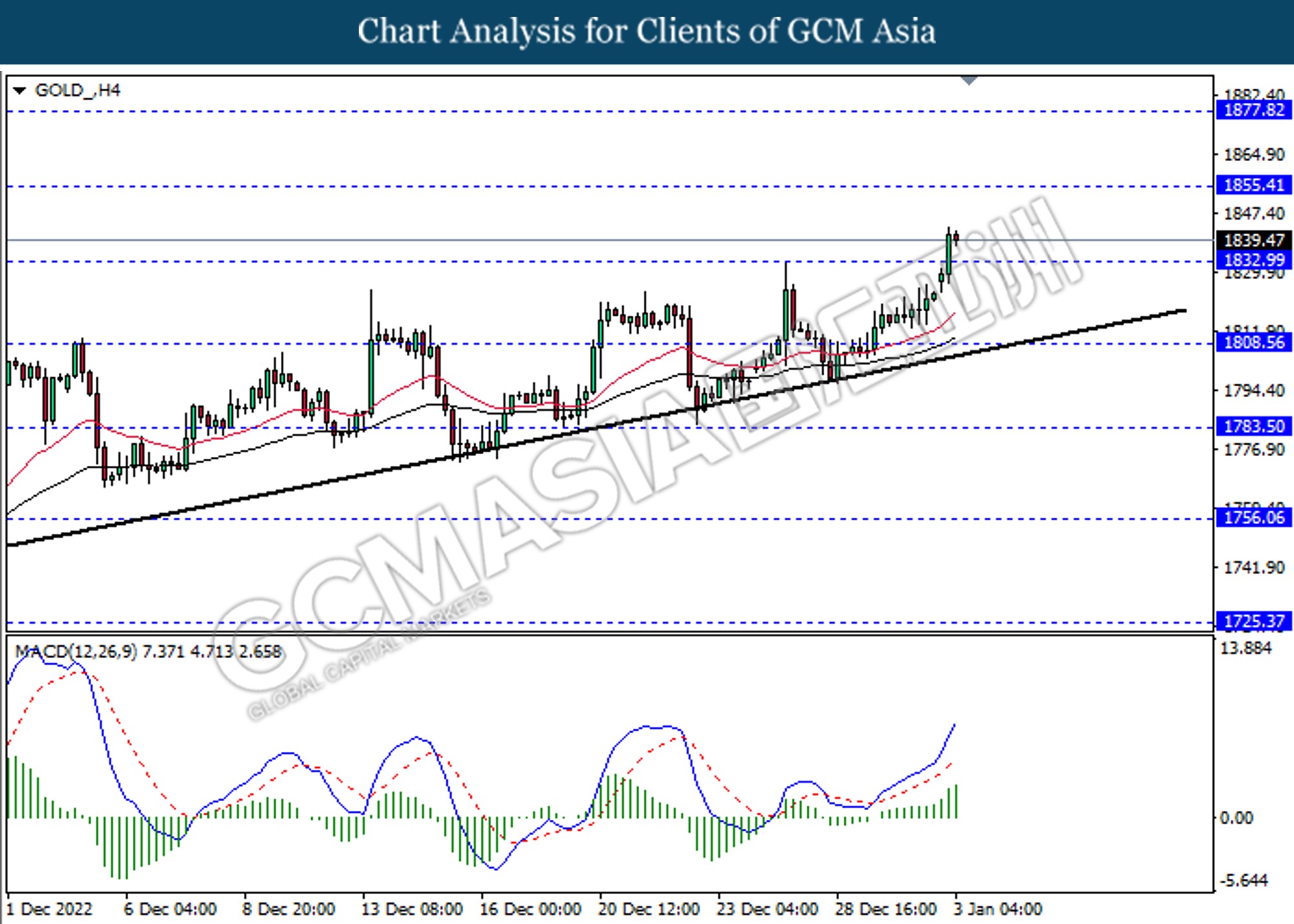

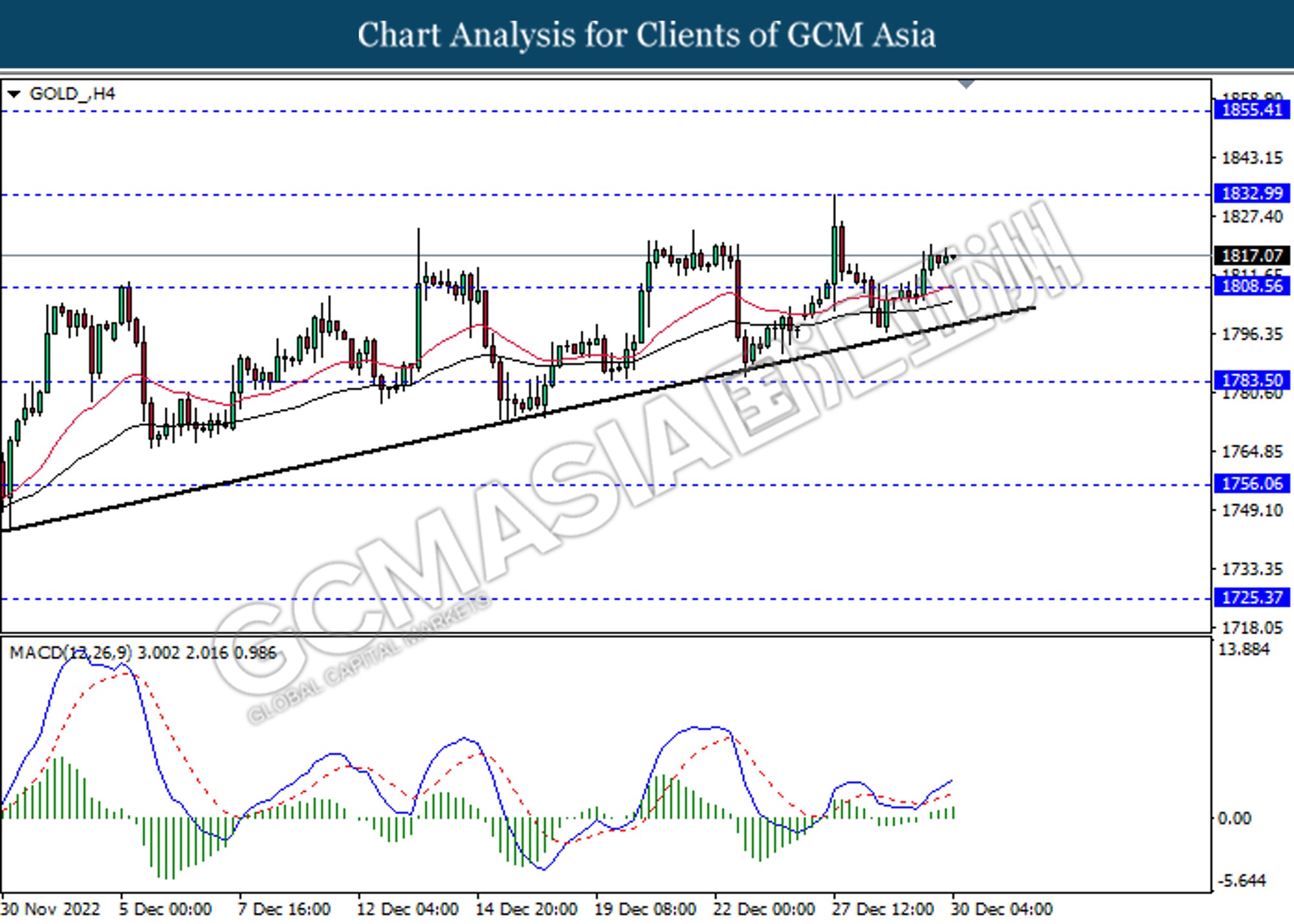

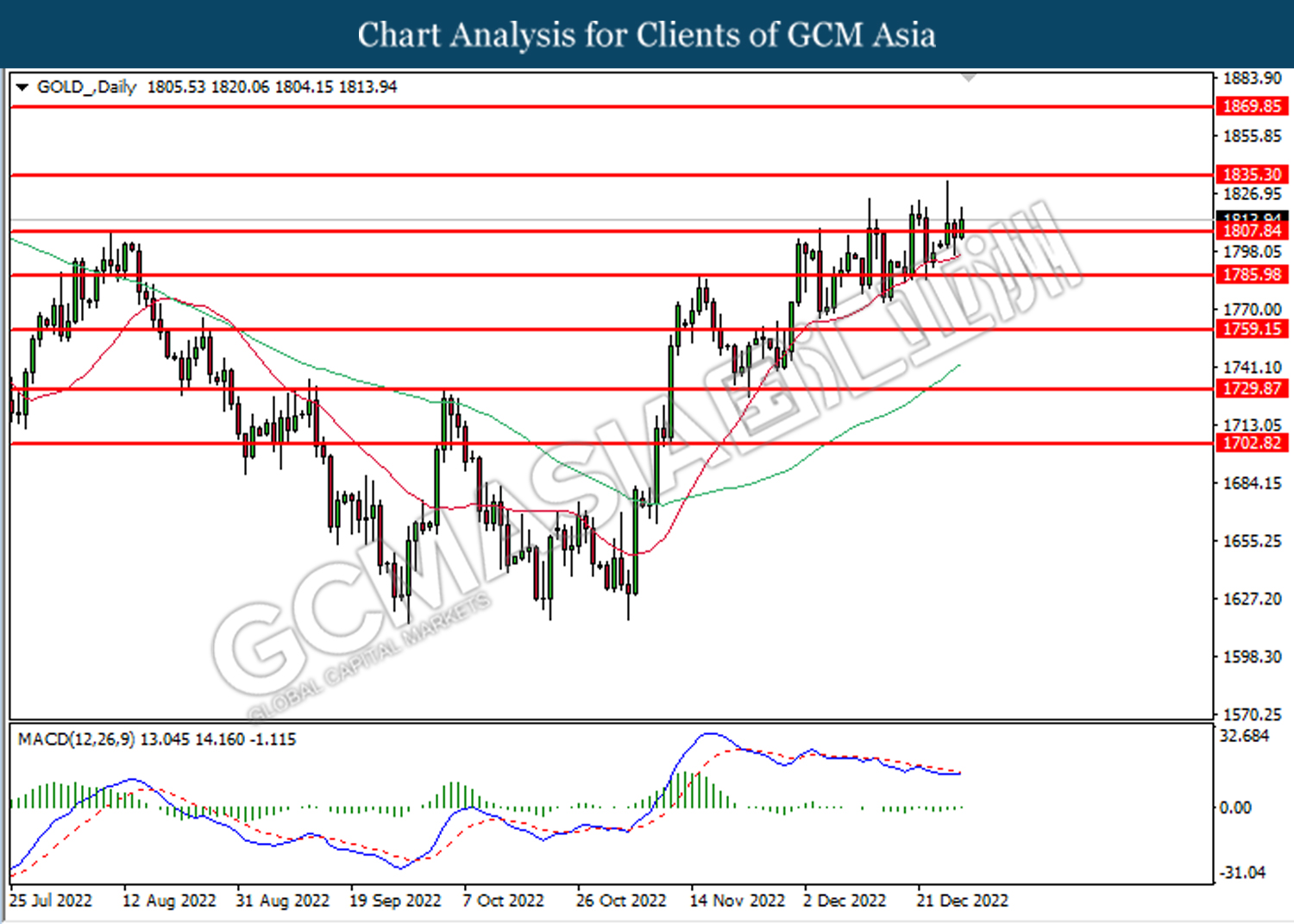

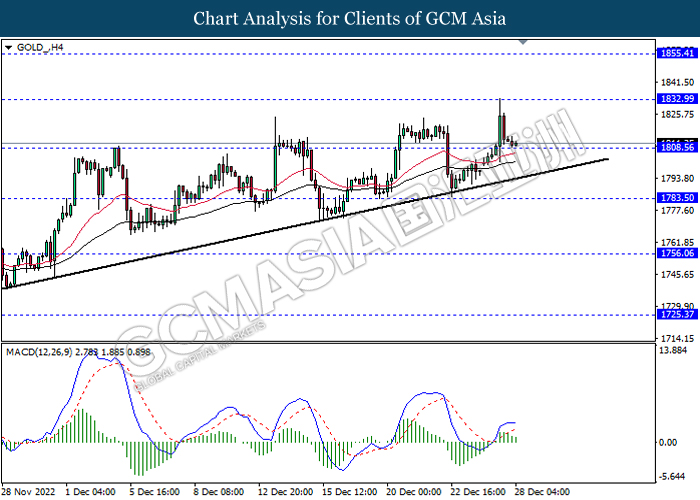

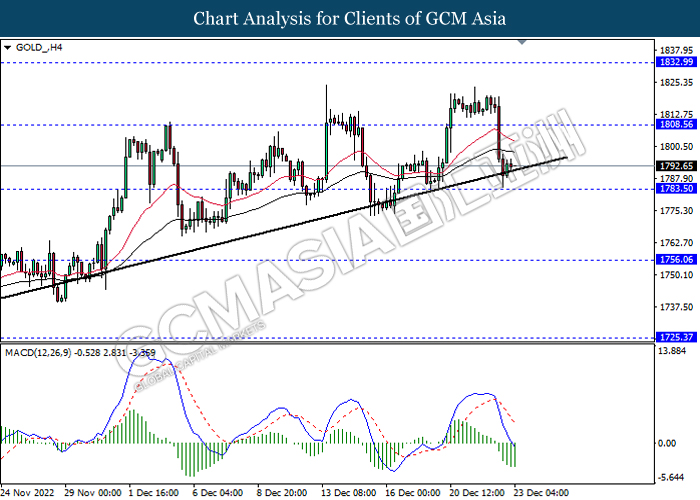

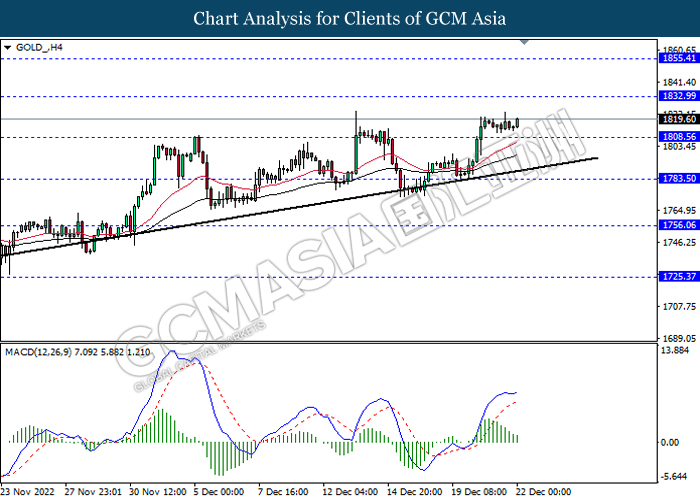

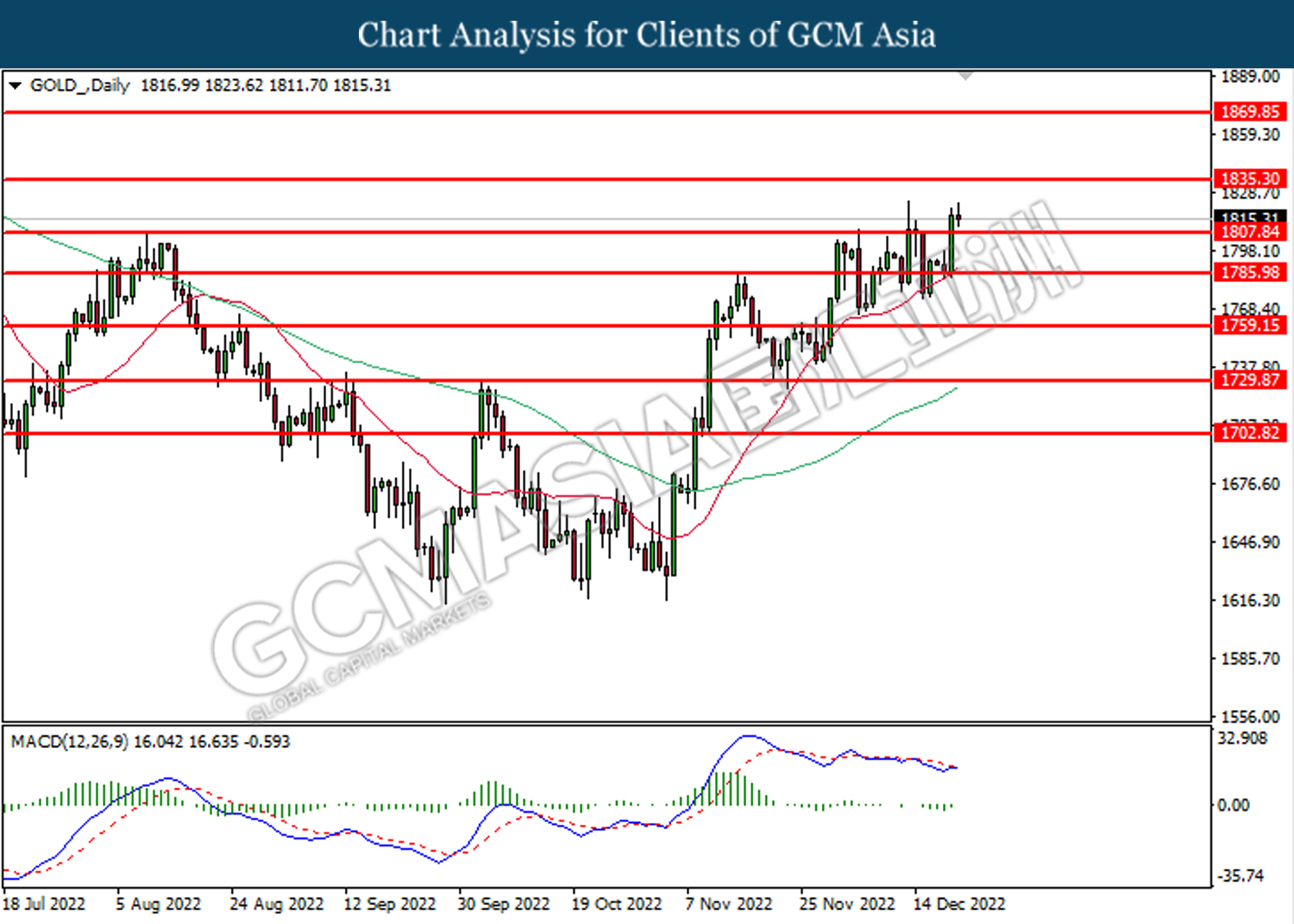

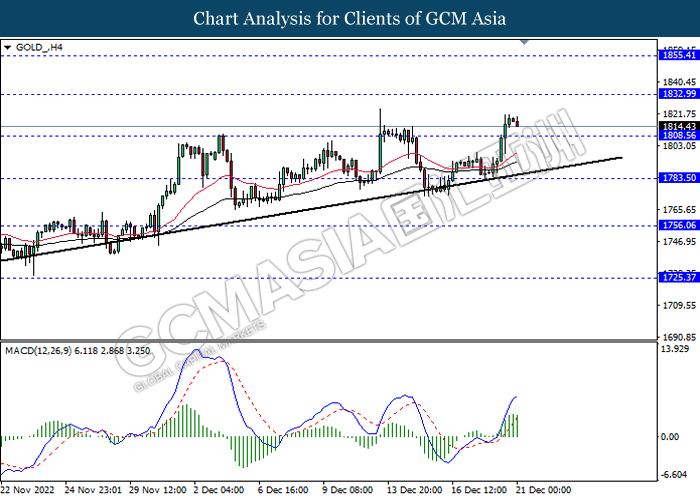

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55

030123 Morning Session Analysis

3 January 2023 Morning Session Analysis

Greenback ended the last trading session of the year 2022 with losses.

The dollar index, which traded against a basket of mainstream currencies, was teetering on the brink as investors resumed the sell-off activity, whereby betting on slower interest rate hikes by the Federal Reserve in the coming meeting. At this juncture, the dollar index hovered near the lowest level since June 2022 as the recent economic data showed that the US inflation has likely peaked, raising the likelihood of less aggressive rate hikes by the Fed. According to the CME FedWatch Tool, the possibility of a just 25 basis point rate hike is 67.7%, whereas the likelihood of a 50 basis point rate hike is 32.3%. On the other hand, the dollar index regained some luster after Germany released downbeat economic data. According to Markit Economics, the Germany Manufacturing Purchasing Managers Index (PMI) came in at 47.1, weaker than the consensus forecast at 47.4, mirroring the risk of the recession still surrounding the nation. Nevertheless, the direction of the dollar index would still be highly dependent on the nation’s economic performance as well as the Fed’s monetary policy stance in the near-term future. As of writing, the dollar index dropped by -0.03% to 103.50.

In the commodities market, crude oil prices increased by 0.02% to $80.55 per barrel as the dollar weakened, benefitting the non-US oil buyers from a lower cost. Besides, gold prices appreciated by 0.02% to $1823.95 per troy ounce amid the weakness in the US dollar.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Year’s Day

All Day JPY Market Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:45 | CNY – Caixin Manufacturing PMI (Dec) | 49.4 | 48.8 | – |

| 16:55 | EUR – German Unemployment Change (Dec) | 17K | 15K | – |

| 17:30 | GBP – Manufacturing PMI (Dec) | 46.5 | 44.7 | – |

| 21:00 | EUR – German CPI (YoY) (Dec) | 10.0% | 9.1% | – |

Technical Analysis

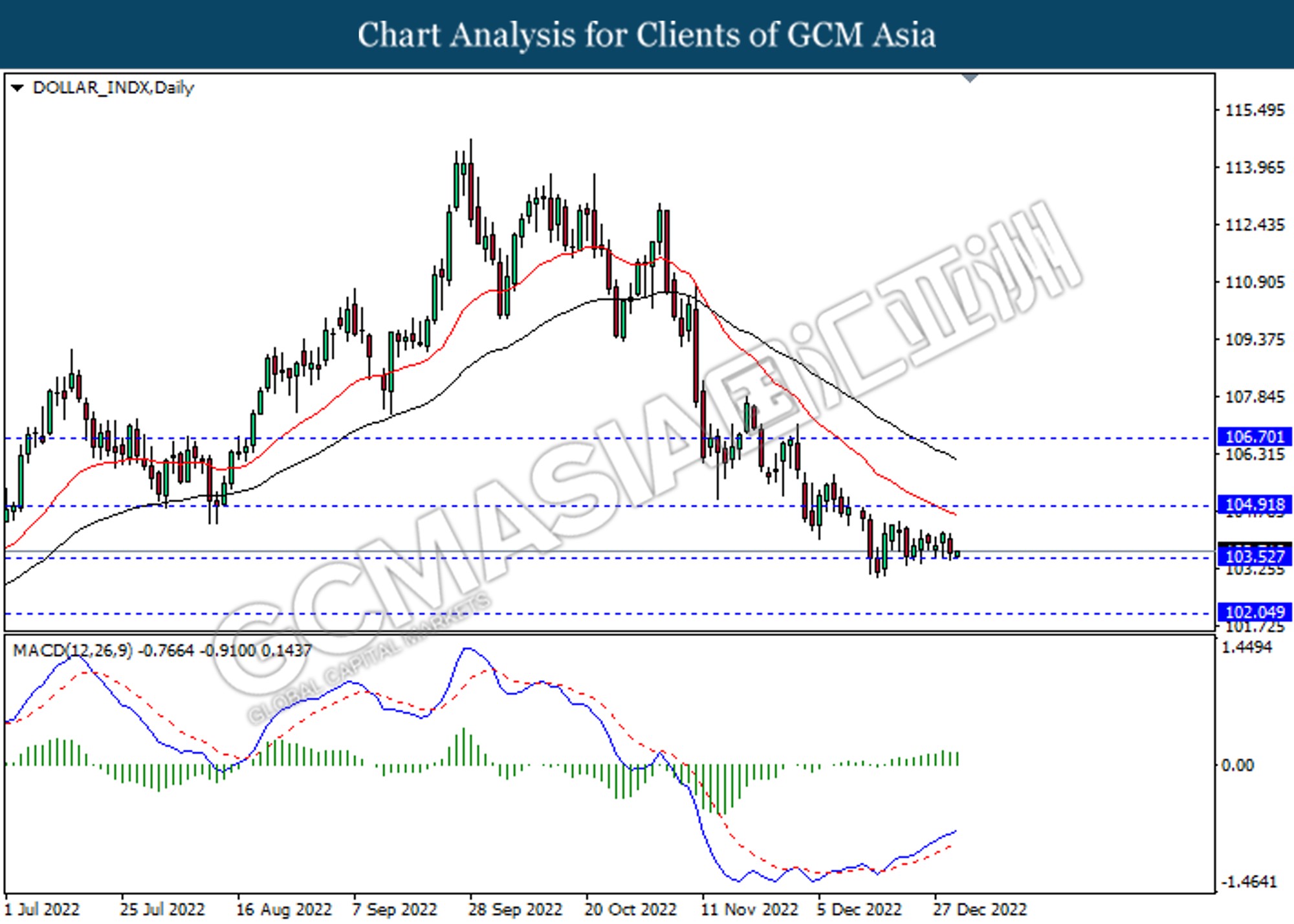

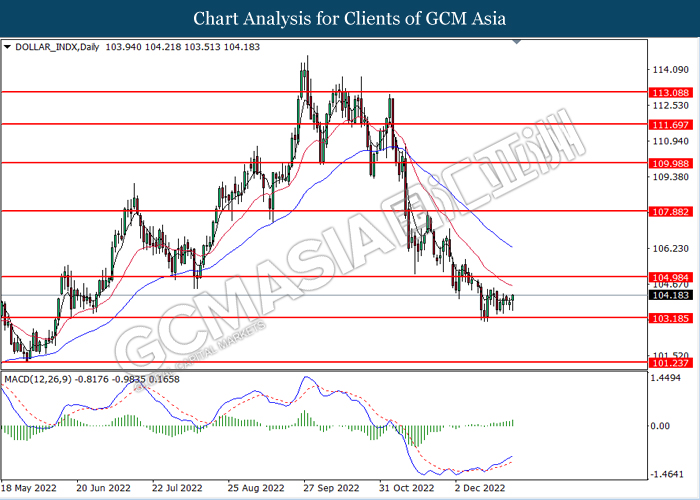

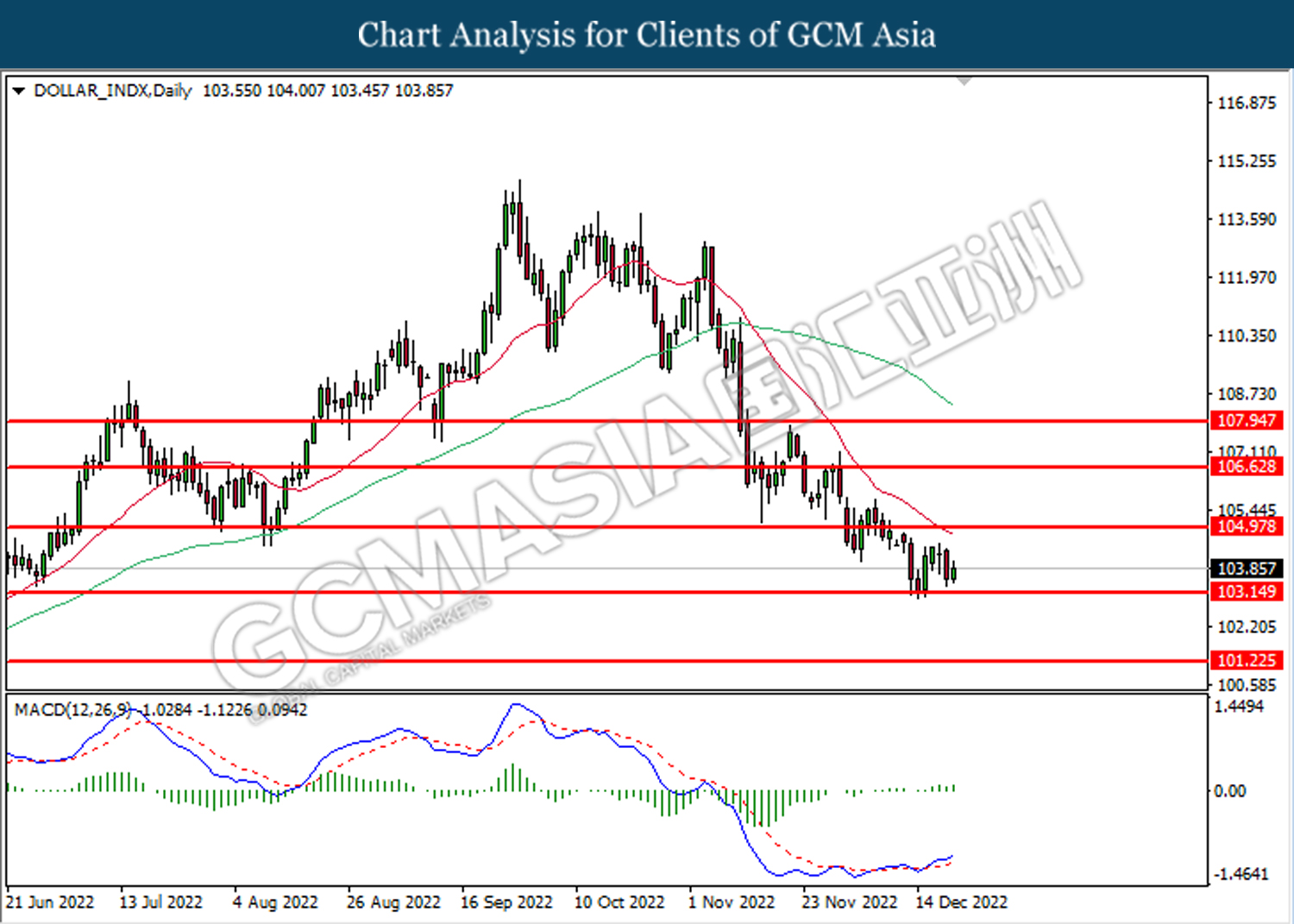

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level at 103.15.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

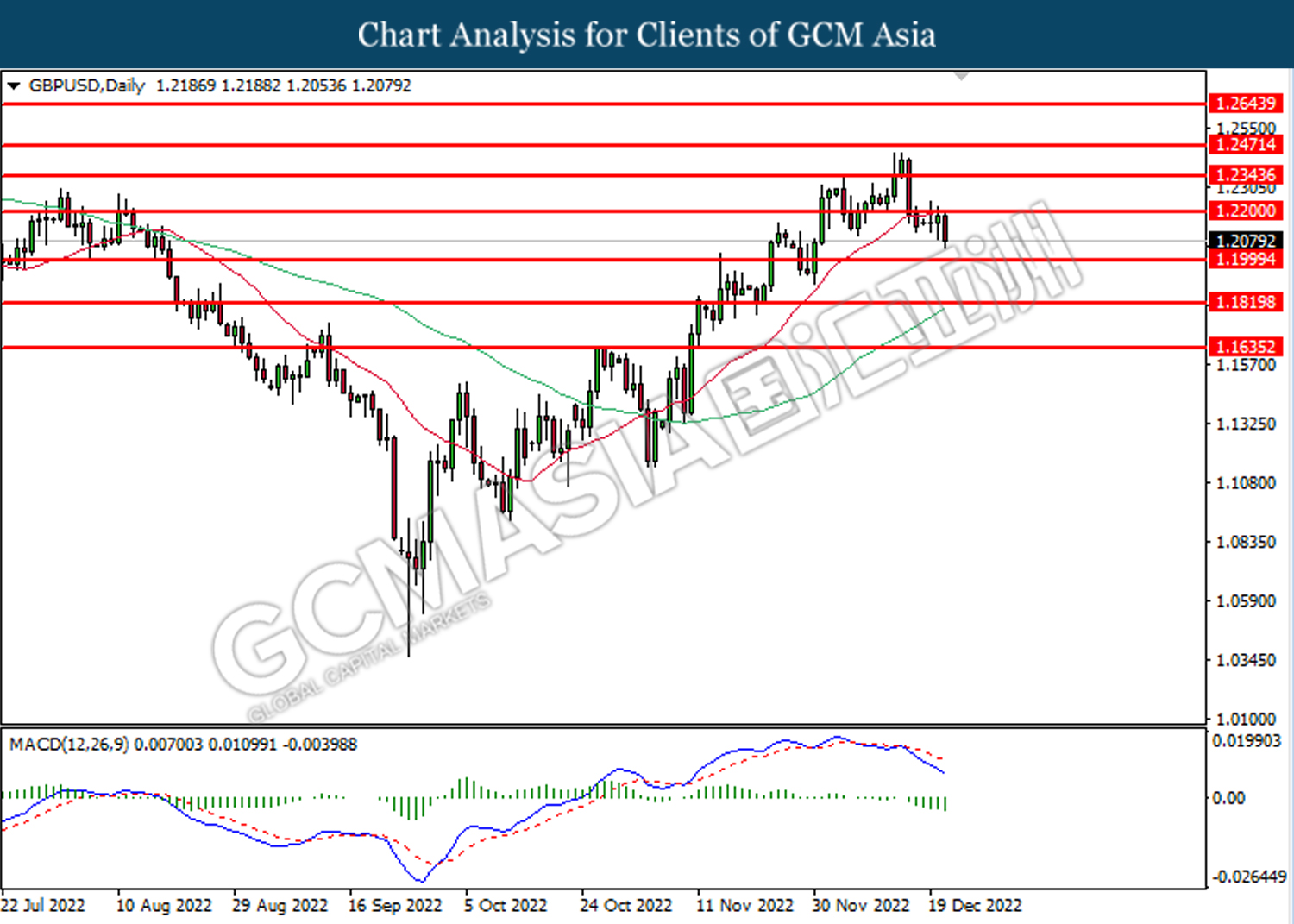

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2000. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

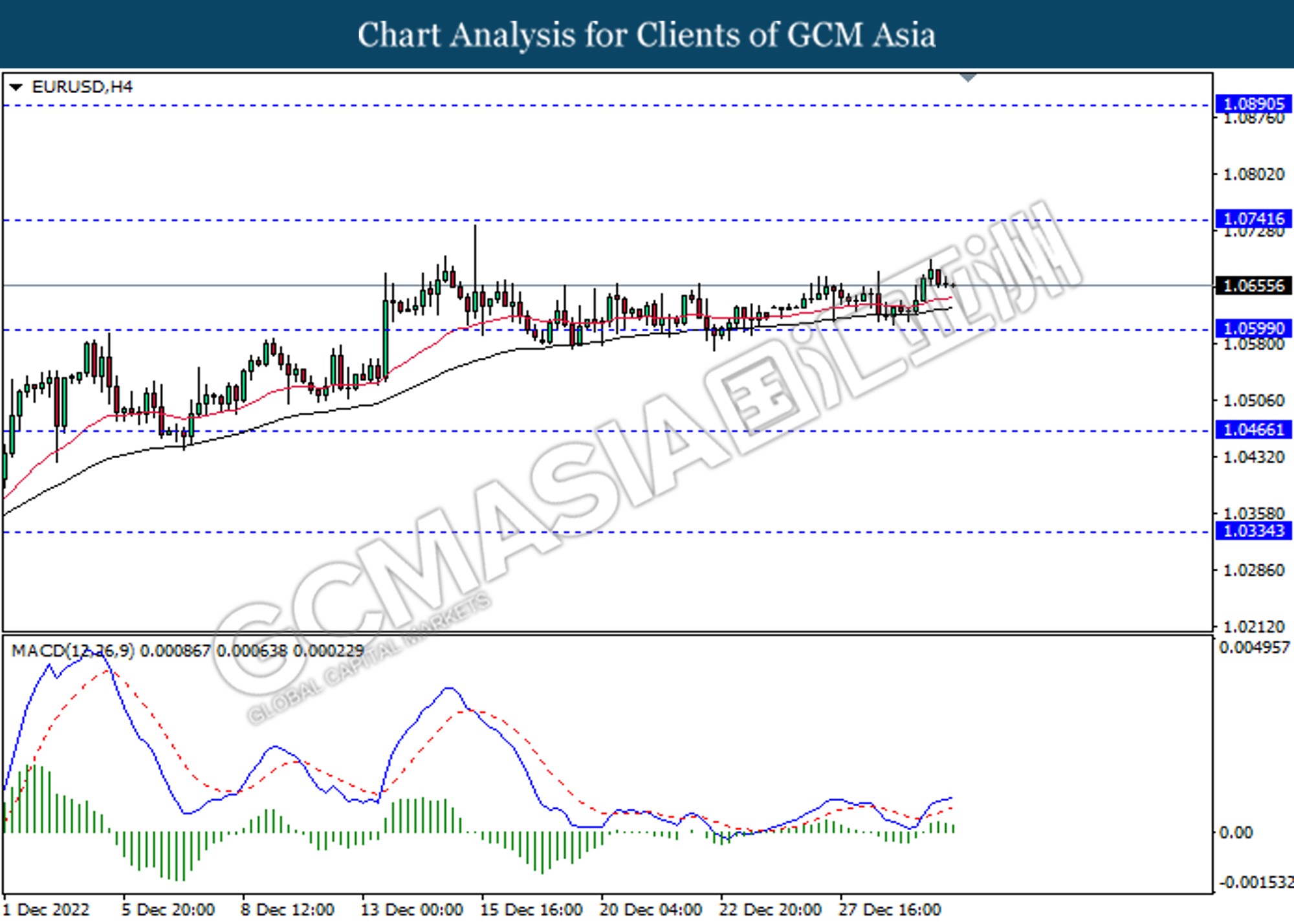

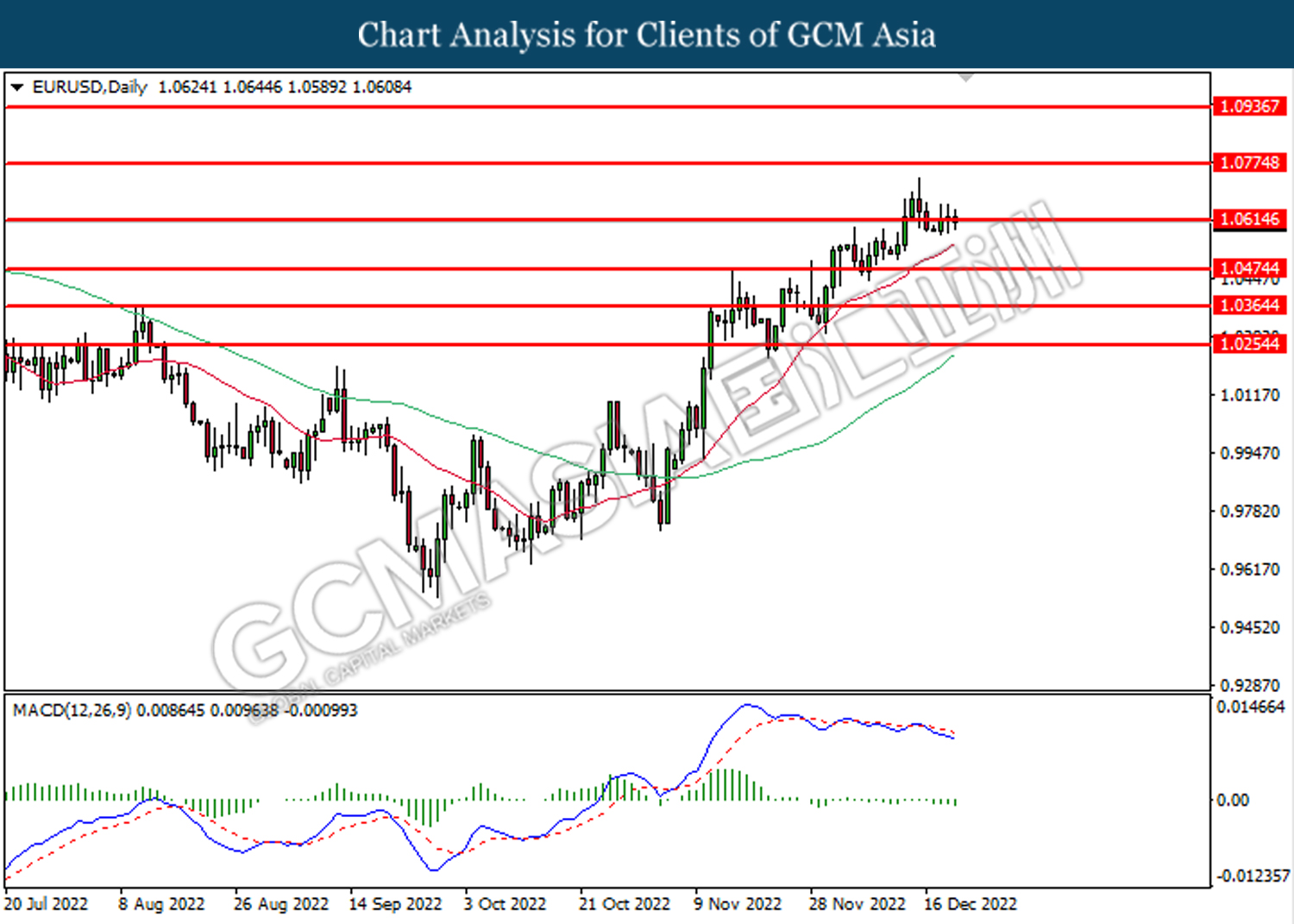

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

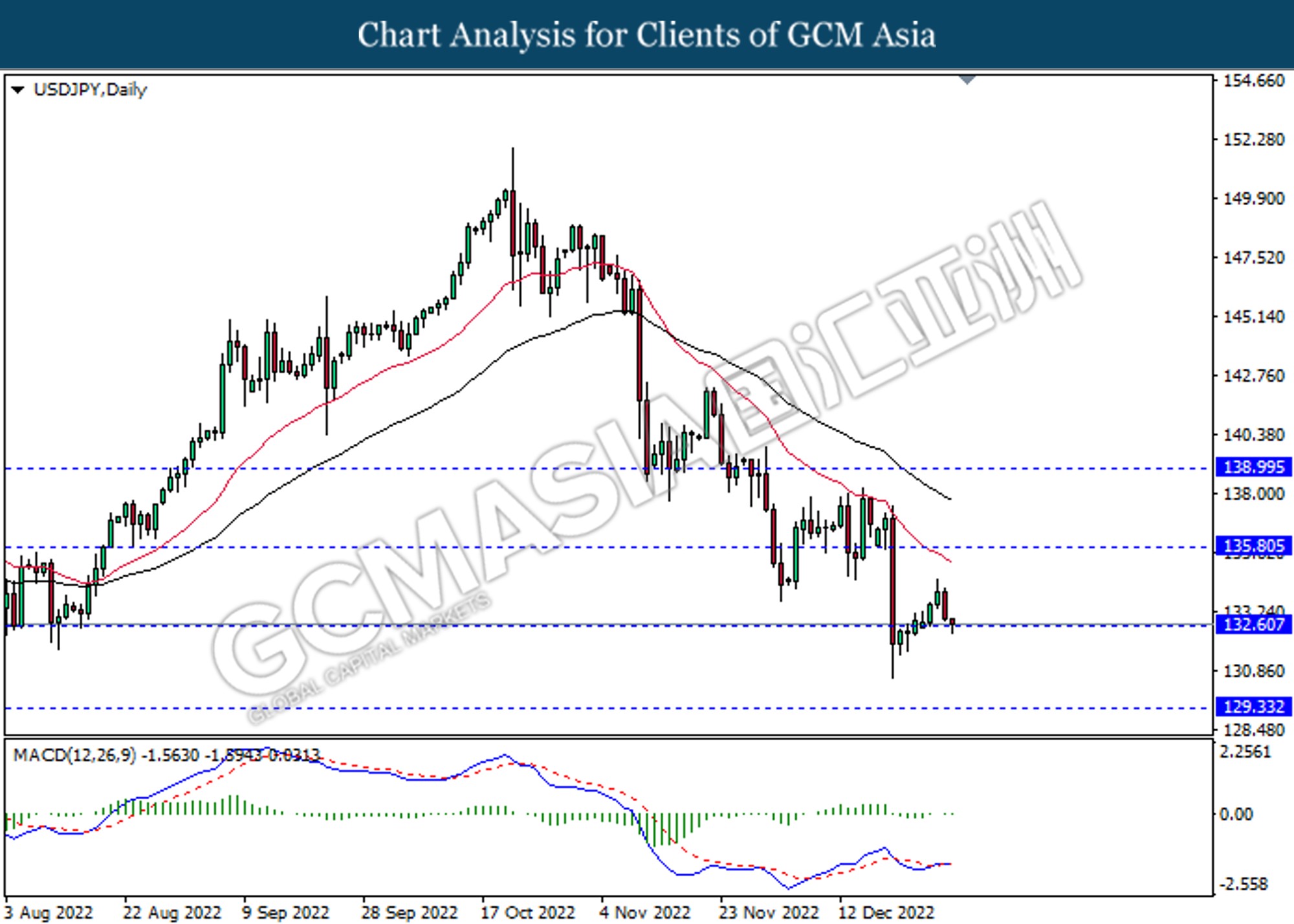

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 131.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 128.60.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6730. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3505. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9225. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

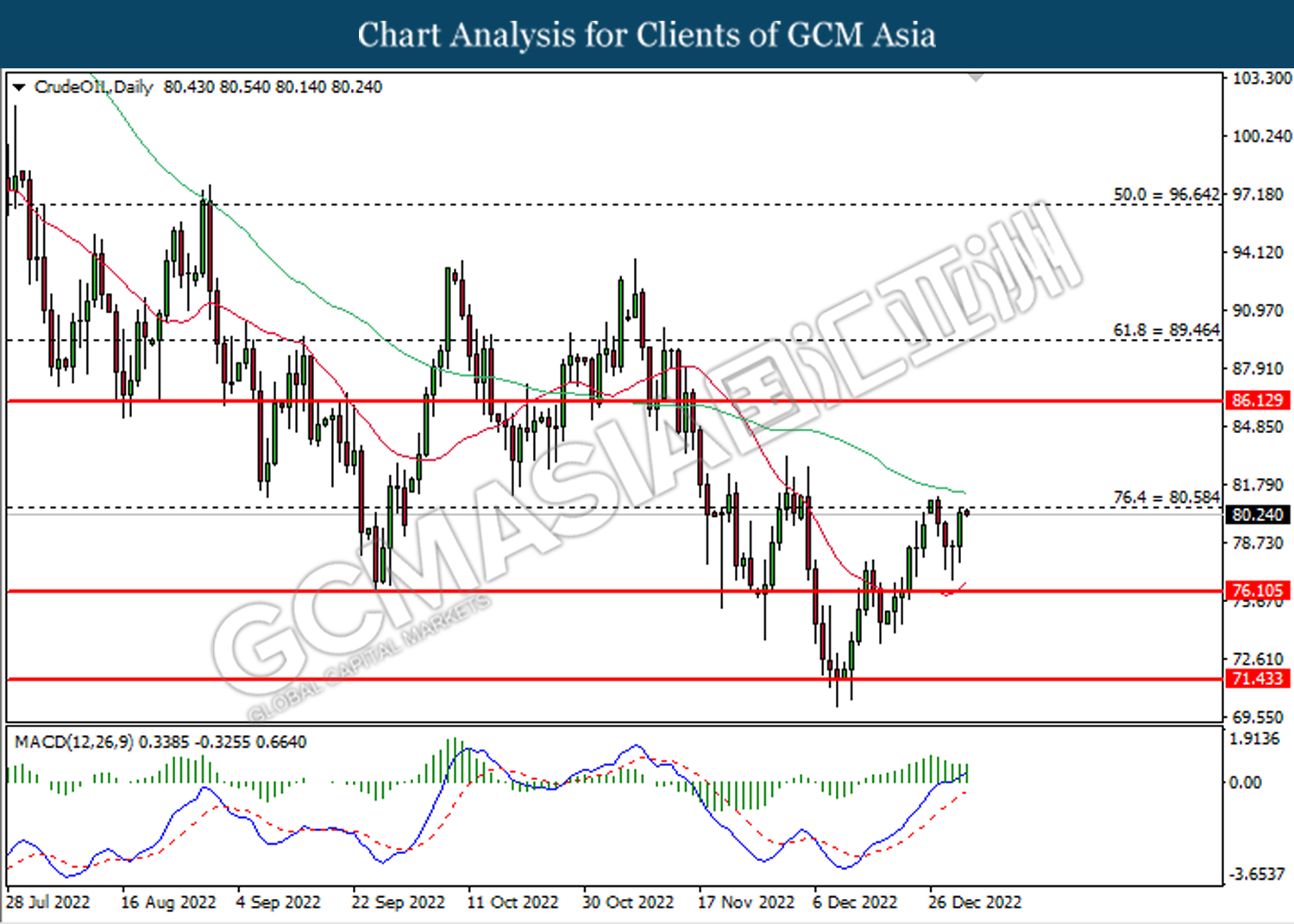

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00

301222 Afternoon Session Analysis

30 December 2022 Afternoon Session Analysis

Euro rose, but remained under pressure over looming recession.

The EUR/USD, which well known by investors around the world rebounded on yesterday over the depreciation of US Dollar, which driven by the rising of US jobless claims. Though, the gains experienced by the Euro was limited amid the background of pessimistic economic outlook in Eurozone. According to Reuters, German exports was anticipated to face challenges in 2023 following the rising Covid-19 infections in China. In fact, China was the major trading partner for Germany, and the deteriorating pandemic would likely to bring negative prospects toward economic progression in China. With that, German economy might be implicated in it. Besides that, the lending rate in Eurozone companies slowed in November, as the rising interest rate by ECB has sparked a possible recession. Nonetheless, it is noteworthy that the ECB has reiterated that the pace of rate hike might be carried forward in order to tame inflation. As of writing, the EUR/USD edged up by 1.0661.

In the commodities market, the crude oil price dropped by 0.05% to $78.36 per barrel as of writing following the increasing of oil inventories. According to EIA, the US Crude Oil Inventories of the week added by 0.718M barrels, which exceeding the market forecast. On the other hand, the gold price depreciated by 0.09% to $1817.27 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

Early close GBP New Year’s Day

Early close NZD New Year’s Day

Early close AUD New Year’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

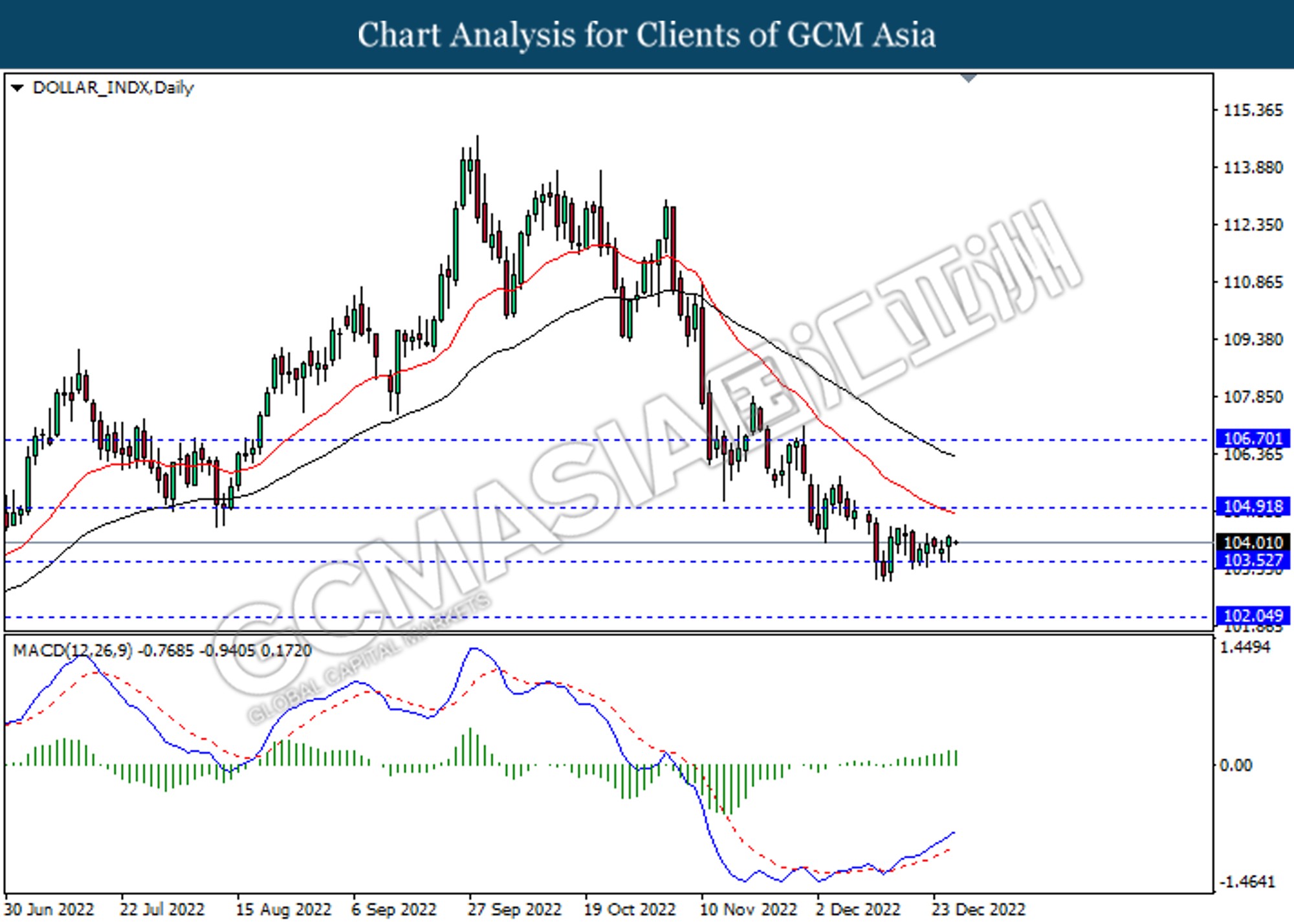

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

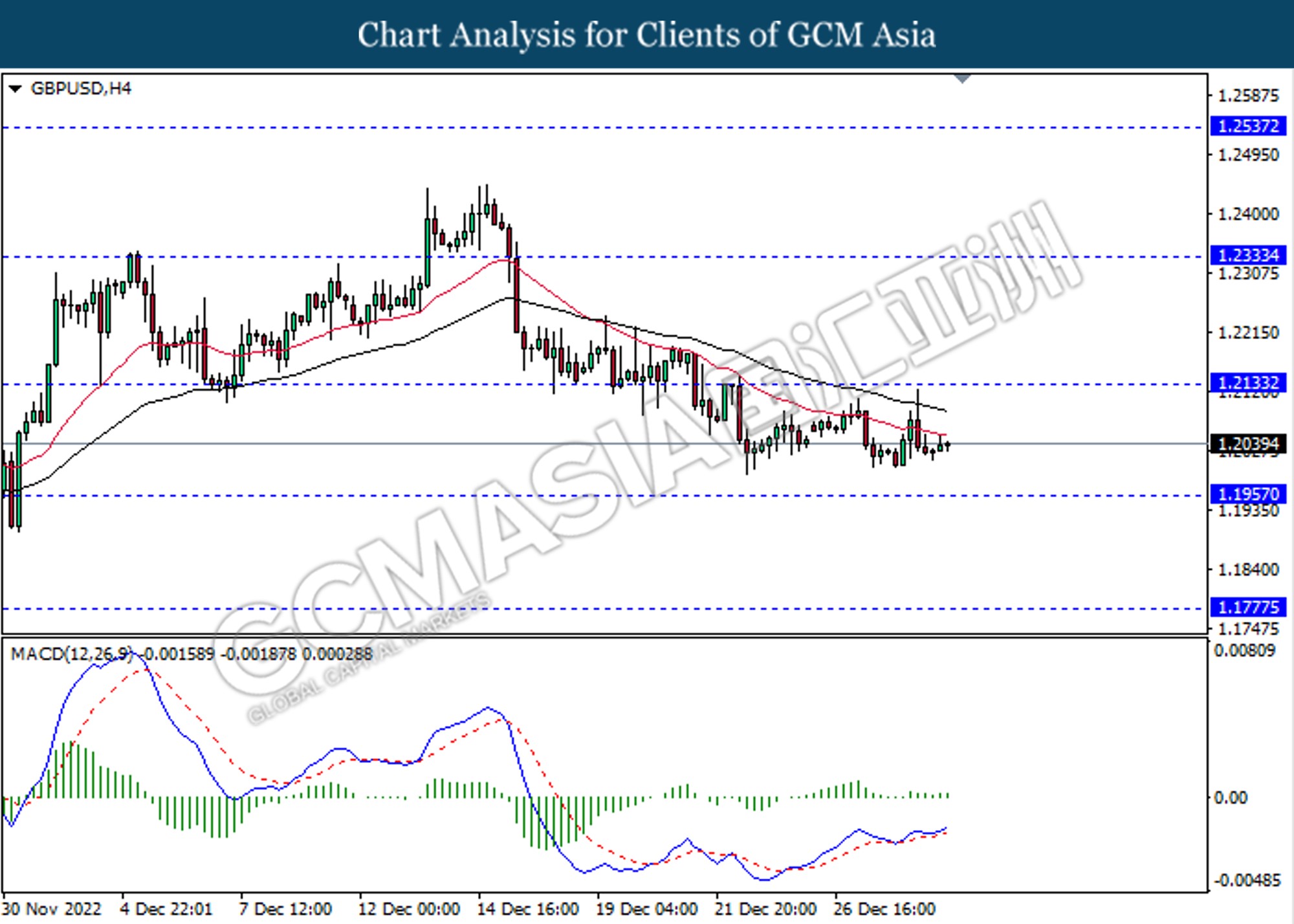

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50

301222 Morning Session Analysis

30 December 2022 Morning Session Analysis

Dollar slid amid China reopening plan and upbeat US job data.

The index, which used to measure US dollar strength or weakness compared to a basket of six major currencies, edged down during the previous trading session as the optimism of the China reopening plan diminished the market demand against the safe haven currency. Earlier this week, Beijing announced that they will reopen the border where the inbound travelers are not mandatory to quarantine starting from 8th January 2023. The step of loosening the curb of Covid-19 in China is expected to drive the growth of global economy, where investors finally could see the light at the end of the tunnel. Besides, a downbeat data from the United States has driven away the investors from the Greenback market. According to the Labor Department, the number of Americans who filed for jobless claims rose from the prior reading’s 216K to 225K this week. The rise in the Initial Jobless Claims data raised the market worries over the resiliency of the US labor market. As of writing, the dollar index dropped by -0.47% to 103.95.

In the commodities market, crude oil prices fell by -0.15% to $78.80 per barrel as the spike in China Covid-19 cases dampened the demand outlook. Besides, gold prices appreciated by 0.59% to $1814.95 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

Early close GBP New Year’s Day

Early close NZD New Year’s Day

Early close AUD New Year’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the previous resistance level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0575. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0575, 1.0475

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 134.15. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term toward the higher level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3600. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 80.60. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00

291222 Afternoon Session Analysis

29 December 2022 Afternoon Session Analysis

Euro plunged as the Eurozone economy headwinds continued.

The EUR/USD, which well known by investors around the world dropped significantly on yesterday as the Eurozone still facing economic headwinds. According to Reuters, the European Central Bank (ECB) Vice President Luis de Guindos claimed on Wednesday that the euro area undergo a difficult economic situation which threatening household as well as businesses. The sky-high inflation, slower economic growth in the European countries has weighed down the market confident on Euro currency, whereas shifting their capitals to flee into safe-haven assets such as US Dollar. Besides that, another negative speech from ECB member has put further pressure on the Euro. ECB Governing Council Gediminas Simkus appeared a speech on yesterday that the Eurozone inflation has not reach its peak, as it showed a half-year lag to that of Lithuania. With that, he emphasized that the energy crisis would likely to be exacerbated if they are unable to access affordable energy. As of writing, the EUR/USD raised by 0.12% to 1.0620.

In the commodities market, the crude oil price plunged by 0.41% to $78.63 per barrel as of writing. However, the oil price has rebounded from its recent low as the API Weekly Crude Oil Stock shown a decreasing circulation. On the other hand, the gold price eased by 0.10% to $1807.31 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 216K | 225K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

291222 Morning Session Analysis

29 December 2022 Morning Session Analysis

Greenback notched up amid risk aversion.

The dollar index, which traded against a basket of mainstream currencies, managed to hold its ground and it regained its luster over the past trading session amid the market risk aversion ahead of the kickoff of year 2023. Prior to that, the market is hyped with the risk-on mood as investors were focused on China restarting its economy and bet on the path of future rate hikes by the Federal Reserve. However, the yield on benchmark U.S. 10-year Treasuries surged significantly and even hit the highest level in nearly 7 weeks as investors eyed 2023 with caution. On top of that, the Greenback received some buy-in momentum after latest minutes from the Bank of Japan suggested its accommodative monetary stance is likely to remain in place. With that, it hit the Japanese Yen as the suggested continuation of ultra-accommodative policy are against with the strategy of the other central bank. Besides, the downbeat result which printed by the Pending Home Sales data limited the gains of dollar index. The data came in at -4.0%, missing the consensus forecast at -0.8%, reflecting the housing sector was hit hard following a series of rate hikes decision by the Federal Reserve. As of writing, the dollar index rose 0.27% to 104.45.

In the commodities market, crude oil price edged down -1.46% to $78.80 per barrel on fears that surging virus cases would hinder a demand uptick in China. Besides, gold prices depreciated by -0.08% to $1805.75 per troy ounce following the rebound in US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 216K | 225K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.20, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2125, 1.2415

Support level: 1.1820, 1.1450

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0570. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0675, 1.0780

Support level: 1.0570, 1.0440

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.35. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.30, 138.90

Support level: 131.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6730. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6895.

Resistance level: 0.6895, 0.7055

Support level: 0.6730, 0.6530

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6280. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6450.

Resistance level: 0.6450, 0.6570

Support level: 0.6280, 0.6110

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3500. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3700.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9215.

Resistance level: 0.9290, 0.9430

Support level: 0.9215, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 79.75. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.55.

Resistance level: 79.75, 82.30

Support level: 76.55, 73.45

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1808.85. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1765.95.

Resistance level: 1808.85, 1835.00

Support level: 1765.95, 1726.25

281222 Afternoon Session Analysis

28 December 2022 Afternoon Session Analysis

Yen remained weak upon the negative factory production.

The USD/JPY, which widely traded by global investors surged during early trading session after the downbeat economic data has been released. The Japan Industrial Production has dropped for a third consecutive month in November, which recorded a -0.1% contraction. In the previous months, the factory output has lowered by 3.2% and 1.7% in October and September respectively. With such backdrop, the market optimism has been dialed down by the deteriorating economy outlook in Japan, which prompting investors to shift their capitals toward safe-haven Dollar. On the other hand, the losses of Japanese Yen was extended following the Bank of Japan (BoJ) was anticipated to remain its ultra-loose monetary policy. According to Reuters, BoJ Governor Haruhiko Kuroda has dismissed the chance of a near-term rate hike, although the core consumer inflation has reached a four-decade high of 3.7%. He deemed on the view price rises were driven by raw material costs, rather than strong demand. As of writing, the USDJPY appreciated by 0.61% to 134.29.

In the commodities market, the crude oil price rose by 0.15% to $79.65 per barrel as of writing following the Russia was expected to retaliate against a price cap on its oil imposed by Western countries. In addition, the gold price depreciated by 0.30% to $1810.23 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – Pending Home Sales (MoM) (Nov) | -4.6% | -0.8% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50

281222 Morning Session Analysis

28 December 2022 Morning Session Analysis

Dollar flat as China eased its lockdown curb.

The index, which used to measure US dollar strength or weakness compared to a basket of six major currencies, lingered near the level of 104.00 as the reopening border of China tampered the market risk-off sentiment. According to the latest news, the China’s National Health Commission has announced that they will stop forcing the inbound travelers to go into quarantine starting from 8th January 2023. As a further step of easing the Covid-19 curb, the China will also downgrade the management of Covid-19 from the current top level of Category A to the less stricter Category B as the disease has found to become less virulent and will evolve to a common type of respiratory infection gradually. With such a backdrop, the China economy is expected to recover strongly after been battered by the frequent lockdown measures since the resurgence of Covid-19, sparkling the market risk-on sentiment. On the other side, the likelihood of aggressive rate hike continues to drop alongside the inflationary pressures showed further sign of easing. Hence, the market failed to see a strong revival in the dollar index at the moment. As of writing, the dollar index dropped -0.14% to 104.15.

In the commodities market, crude oil prices up by 1.66% to $80.75 per barrel as China decided to loosen its Covid-19 restrictions starting from 8th January, boosting the market hopes of a demand recovery in the near-term future. Besides, gold prices appreciated by 0.85% to $1813.65 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – Pending Home Sales (MoM) (Nov) | -4.6% | -0.8% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the previous resistance level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0575. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0575, 1.0475

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower while currently retesting the support level at 0.6725. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently retesting the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3505. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9310.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00

271222 Afternoon Session Analysis

27 December 2022 Afternoon Session Analysis

Yen depreciated as the spiking inflation keep menacing Japan economy.

The USD/JPY, which widely traded by global investors jumped on Tuesday after the downbeat economic data has been released. The Japan Retail Sales YoY for November has notched down from the previous reading of 4.4% to 2.6%, missing the consensus forecast of 3.7%. The sales fell from the previous month with price increases in daily necessities weighing on Japanese households as the nation’s core consumer inflation hit a fresh 40-year high, which threatening the consumption power in the Japan. With that, it stoked a shift of sentiment toward safe-haven assets such as US Dollar. Though, the gains experienced by USD/JPY was limited following the easing inflationary risk in the US. Last week, the US Core Personal Consumption Expenditure (PCE) Price Index has decreased from the previous figures, whereas the pace of aggressive rate hikes progress would likely to be scaled back. Thus, it dragged down the appeal of US Dollar. As of now, the movement of FX market was expected to be slower as the market was lack of catalyst. As of writing, the USD/JPY edged up by 0.04% to 132.91.

In the commodities market, the crude oil price appreciated by 0.69% to $80.11 per barrel as of writing following the lowered inflation risk in the US has dialed up the demand of this black commodity. On the other hand, the gold price rose by 0.47% to $1805.32 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP Christmas

All Day NZD Christmas

All Day AUD Christmas

All Day CAD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

271222 Morning Session Analysis

27 December 2022 Morning Session Analysis

FX Market slowed amid Christmas Holiday.

The dollar index, which traded against a basket of six major currencies, slid last Friday as the economic data signaled that the U.S. economy is cooling down, hyping the market expectation of slower rate hike in the future as inflation eased. According to the Bureau of Economic Analysis, excluding the volatile food and energy components, the PCE index up 0.2% after increasing 0.3% in October, in line with the market consensus. The inflation data showed that it is moving in the right direction, whereby it is in the gradual pace of easing while the US economic growth has not been hindered significantly. At this juncture, the Fed is expected to raise the interest rate by 25 basis points in the next meeting, which is scheduled to be held in the month of February. However, due to the Christmas Holiday, the trading condition in the FX market remains subdued and thinned as the market participants stayed calm.

In the commodities market, crude oil price rose by 1.30% to $80.67 per barrel after Russia said it could cut crude output in response to the G7 price cap on Russian exports Besides, gold prices appreciated by 0.14% to $1800.70 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day GBP Christmas

All Day NZD Christmas

All Day AUD Christmas

All Day CAD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.20, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2125, 1.2415

Support level: 1.1820, 1.1450

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0570. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0675, 1.0780

Support level: 1.0570, 1.0440

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.35. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.30, 138.90

Support level: 131.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance at 0.6730. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6730, 0.6895

Support level: 0.6530, 0.6400

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6280. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6450.

Resistance level: 0.6450, 0.6570

Support level: 0.6280, 0.6110

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9430.

Resistance level: 0.9430, 0.9575

Support level: 0.9290, 0.9215

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 79.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 82.30.

Resistance level: 82.30, 84.85

Support level: 79.75, 76.55

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1808.85. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1765.95.

Resistance level: 1808.85, 1835.00

Support level: 1765.95, 1726.25

231222 Afternoon Session Analysis

23 December 2022 Afternoon Session Analysis

Pound Sterling dived over the economy contraction fears rose.

The GBP/USD, which widely traded by global investors slumped on yesterday after the downbeat economic data has been released. According to Office for National Statistics, the UK third quarter GDP has contracted by 0.3%, which exceeding the market forecast of -0.2% contraction. With that, it dialed down market optimism toward economic progression in the UK, which spurring bearish momentum on the Pound Sterling. Besides that, the Bank of England (BoE) has estimated that the UK economy would be facing recession in the fourth quarter during earlier moment, as well as the GDP was anticipated to shrink by 0.3% in the fourth quarter of this year. The spiking inflation that driven by rising tension of Russia-Ukraine was the main factor to cause diminishing of household spending. On the other hand, Pound Sterling has lost its further ground amid the optimistic economic outlook in the US, whereas attracting market participants to shift their capitals toward US market. As of writing, the GBP/USD edged up by 0.02% to 1.2045.

In the commodities market, the crude oil price appreciated by 1.02% to $78.29 per barrel as of writing after a sharp decline throughout overnight trading session over the rising fears of Fed aggressive rate hikes. In addition, the gold price raised by 0.30% to $1792.72 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

Early close GBP Christmas

Early close NZD Christmas

Early close AUD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Nov) | 0.5% | 0.1% | – |

| 21:30 | USD – Core PCE Price Index (YoY) (Nov) | 0.2% | 0.2% | – |

| 21:30 | CAD – GDP (MoM) (Oct) | 0.1% | 0.1% | – |

| 23:00 | USD – New Home Sales (Nov) | 632K | 600K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

231222 Morning Session Analysis

23 December 2022 Morning Session Analysis

Dollar climbed as recession fears wiped off.

The dollar index, which traded against a basket of six major currencies, extended its rally during the US market trading hours as a series of upbeat data put out the market fears against the recession risk. According to the Bureau of Economic Analysis, the US GDP for the third quarter rose 3.2%, beating both the consensus forecast and prior quarter reading at 2.9%. The stronger-than-expected GDP was mainly attributed to the increases in exports, consumer spending, oversea fixed investment as well as the government spending. Following the release of the data, investors rushed into the US dollar market as recession risk faded, while showing a better economic health condition compared to the other region. On top of that, the US Department of Labor also reported that the weekly initial jobless claim increased slightly from 214K to 216K, but still lower than the consensus forecast at 222K. Nevertheless, it is still showing that the US labor market remained resilience, against the market expectation. As of writing, the dollar index rose by 0.23% to 104.40.

In the commodities market, crude oil price was down by -1.54% to $77.30 per barrel as the cost oil purchase jumped following the appreciation of US dollar. Besides, gold prices depreciated by -1.20% to $1792.55 per troy ounce amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

Early close GBP Christmas

Early close NZD Christmas

Early close AUD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Nov) | 0.5% | 0.1% | – |

| 21:30 | USD – Core PCE Price Index (YoY) (Nov) | 0.2% | 0.2% | – |

| 21:30 | CAD – GDP (MoM) (Oct) | 0.1% | 0.1% | – |

| 23:00 | USD – New Home Sales (Nov) | 632K | 600K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.20, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2125, 1.2415

Support level: 1.1820, 1.1450

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0570. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0675, 1.0780

Support level: 1.0570, 1.0440

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.35. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.30, 138.90

Support level: 131.35, 126.65

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6730. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6530.

Resistance level: 0.6730, 0.6895

Support level: 0.6530, 0.6400

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6280. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6110.

Resistance level: 0.6280, 0.6450

Support level: 0.6110, 0.5900

USDCAD, Daily: USDCAD was traded higher following prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9290, 0.9430

Support level: 0.9215, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.55. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 79.75.

Resistance level: 79.75, 82.30

Support level: 76.55, 73.45

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1808.85. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1765.95.

Resistance level: 1808.85, 1835.00

Support level: 1765.95, 1726.25

221222 Afternoon Session Analysis

22 December 2022 Afternoon Session Analysis

Canada Dollar lingered following mixed sentiment.

The USD/CAD, which widely traded by global investors hovered on yesterday following the mixing sentiment of market. According to Statistic Canada, the inflationary data that excluding food and energy price, Core Consumer Price Index in Canada has slipped in November, which notched down from the previous reading of 0.4% to 0.0%. With such backdrop, the Canada central bank would likely to scale back its rate hike pace, spurring bearish momentum toward Canada Dollar. Though, the losses of the pairing was limited over the upbeat US economic data. On the other hand, the EUR/USD edged down throughout Wednesday trading session after a dovish statement has been unleashed by ECB member. According to Reuters, the ECB board member Mario Centeno made his comments yesterday that the inflation in Eurozone was reaching its peak in the fourth quarter of 2022, which based on the data shown. Thus, it hinted that a lower interest rate might be raised in the next meeting. As of writing, the USD/CAD dropped by 0.11% to 1.3595, while EUR/USD rose by 0.28% to 1.0633.

In the commodities market, the crude oil price appreciated by 0.41% to $78.60 per barrel as of writing following top oil importer China continued to relax safeguards on the COVID-19 front. On the other hand, the gold price rose by 0.15% to $1819.07 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 2.4% | 2.4% | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 211K | 222K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50

221222 Morning Session Analysis

22 December 2022 Morning Session Analysis

US Dollar revived amid consumer confidence bounced back.

The dollar index, which traded against a basket of six major currencies, regained its luster over the past trading session as a positive economic data showed some recovery on the level of consumer confidence toward the nation’s economy. According to the Conference Board, the US CB Consumer Confidence data bounded sharply from the prior month reading’s 101.4 to 108.3, significantly higher than the consensus forecast at 101.0. The improvement of the consumer confidence was due to consumers’ more favorable view regarding the economy and jobs. With the data also hit the highest level since April 2022, it is also showing that the consumer’s willingness on higher spending will continue in the near-term future, at least the first quarter of 2023 despite the headwinds of inflation and rate hikes plan from the Federal Reserve. Moreover, the retracement of Japanese Yen has boosted the appeal of dollar index, whereby the slump in the Yen market was mainly due to profit taking activity after skyrocketing for more than 5.00%. As of writing, the dollar index rose 0.27% to 104.25.

In the commodities market, crude oil prices up by 2.80% to $78.25 per barrel as EIA reported crude oil inventory draw for the past one week. According to the EIA, US Crude Oil Stock dropped by -5.894M, while the consensus forecast was -1.657M. Besides, gold prices depreciated by -0.19% to $1814.30 per troy ounce amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 2.4% | 2.4% | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 211K | 222K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the previous resistance level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0615. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 80.60.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00

211222 Afternoon Session Analysis

21 December 2022 Afternoon Session Analysis

Canada Dollar jumped as nation spending increased.

The USD/CAD, which widely traded by global investors slumped on yesterday after the upbeat economic data has been released. According to Statistics Canada, the Canada Core Retail Sales MoM for October notched up from the previous reading of -0.8% to 1.7%, exceeding the consensus expectation of 1.4%. The rising of consumer spending in Canada nation has brought positive prospects toward economic progression of the country, whereas attracting the eyes of investors. On the other hand, the EURUSD has recovered some lost ground throughout overnight trading session following the positive speech from European Central Bank (ECB) member. According to Bloomberg, ECB Governing Council member Francois Villeroy de Galhau claimed on Tuesday that the Eurozone economy would less likely to face a hard recession amid the implementation of rate hikes for tamping spiking inflation. Besides that, while easing the pace of rate hikes last week, the ECB has made clear that it has no intention of halting them any time soon. As of writing, the USDCAD edged down by 0.01% to 1.3609, while the EURUSD depreciated by 0.06% to 1.0615.

In the commodities market, the crude oil price rose by 0.25% to $76.41 per barrel as of writing following the China’s crude oil imports has increased by 17% in November from a year earlier. In addition, the gold price appreciated by 0.01% to $1815.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core CPI (MoM) (Nov) | 0.4% | – | – |

| 23:00 | USD – CB Consumer Confidence (Dec) | 100.2 | 101.0 | – |

| 23:00 | USD – Existing Home Sales (Nov) | 4.43M | 4.20M | – |

| 23:30 | CrudeOIL- Crude Oil Inventories | 10.231M | -1.657M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50