211222 Morning Session Analysis

21 December 2022 Morning Session Analysis

Greenback plunged as Yen surged on policy shift.

The dollar index, which traded against a basket of six major currencies, lost its ground while recording some losses during the previous trading session as the policy tweak from Bank of Japan (BoJ) boosted the appeal of Japanese Yen. In the BoJ meeting, the board of members agreed to maintain its policy settings broadly unchanged, leaving the short-term Japanese government bond yields at -0.1% and the 10-year yield at 0.00%. However, the BoJ made a surprise decision to let the 10-year yield to rise as high as 0.5% from a previous cap of 0.25%. The policy shift in adjusting the boundary deviation of long-term yield shocked the market participants, as it was a shift away from its long-running dovish stance of ultra-easing policy. On top of that, the dollar index received further bearish momentum after the US Census Bureau released a downbeat housing data yesterday. The US Building Permits dropped from the prior month reading of 1.512M to 1.342M, lower than the consensus forecast at 1.485M. As of writing, the pair of USD/JPY rebounded slightly by 0.05% to 131.75.

In the commodities market, crude oil prices up by 0.18% to $76.10 per barrel amid weakening of dollar index as well as the large draw in the US API Inventory data. Besides, gold prices depreciated by 0.01% to $1818.05 per troy ounce amid the weakening of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core CPI (MoM) (Nov) | 0.4% | – | – |

| 23:00 | USD – CB Consumer Confidence (Dec) | 100.2 | 101.0 | – |

| 23:00 | USD – Existing Home Sales (Nov) | 4.43M | 4.20M | – |

| 23:30 | CrudeOIL- Crude Oil Inventories | 10.231M | -1.657M | – |

Technical Analysis

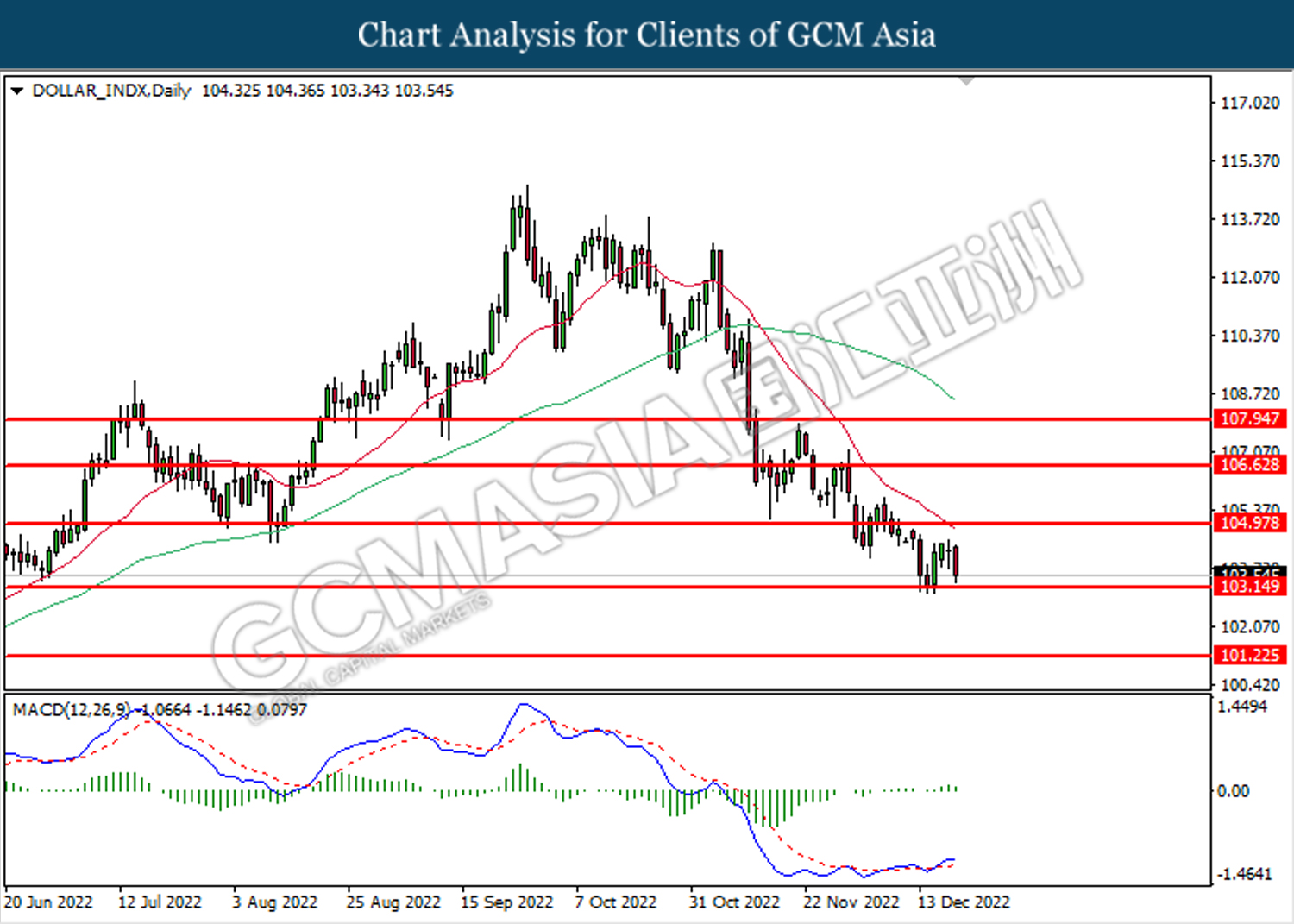

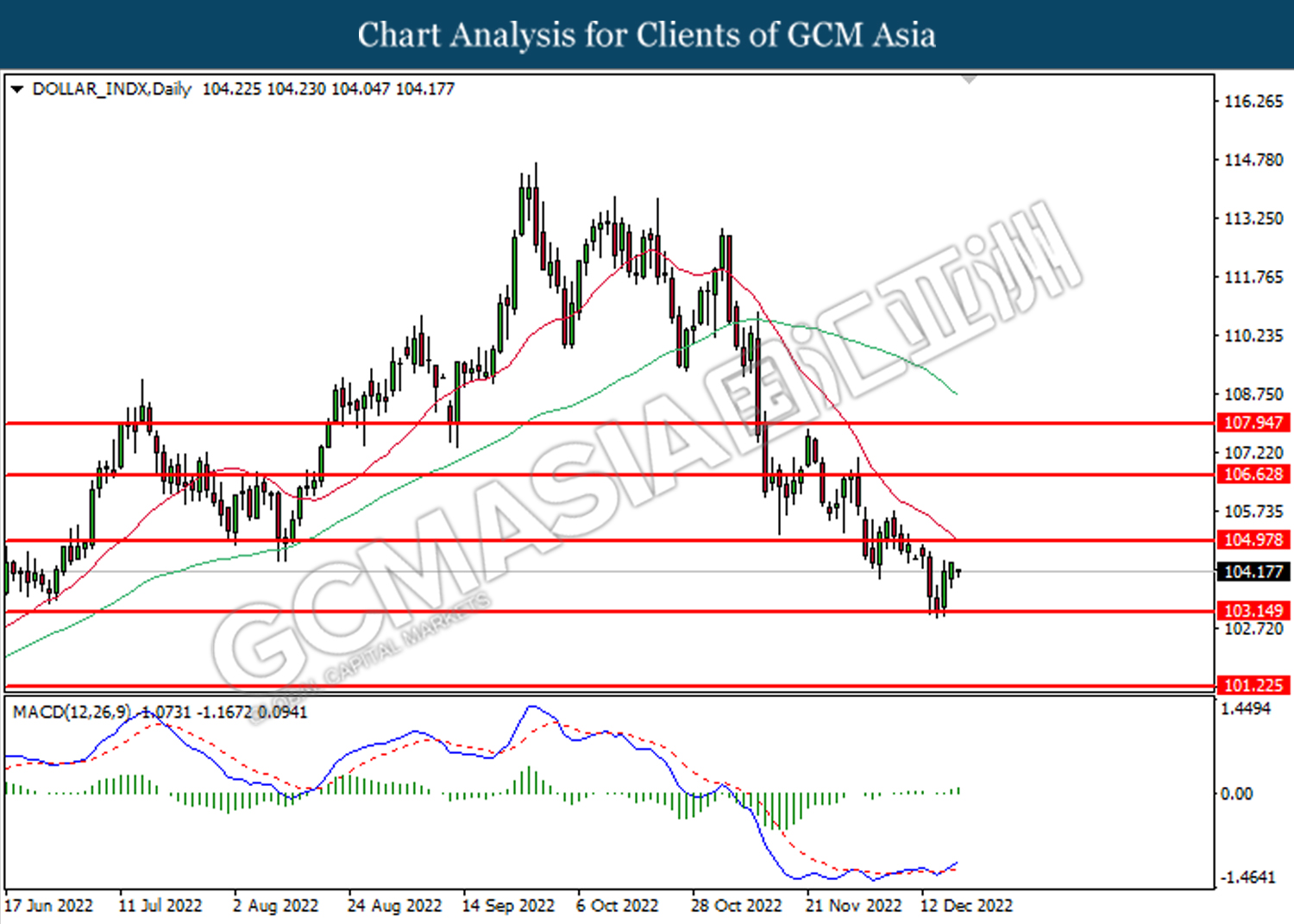

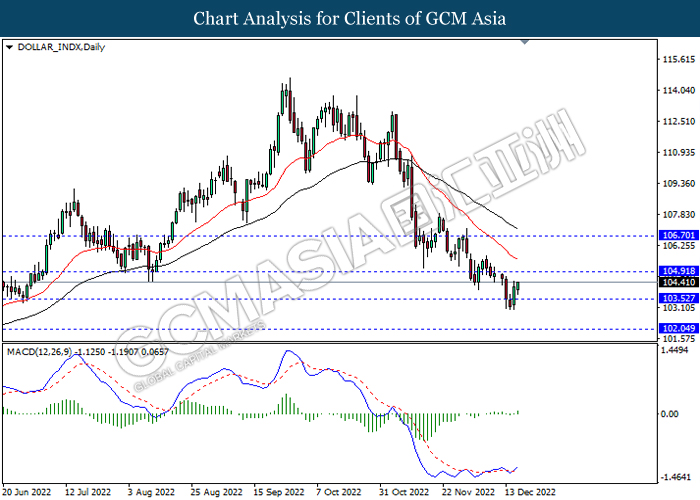

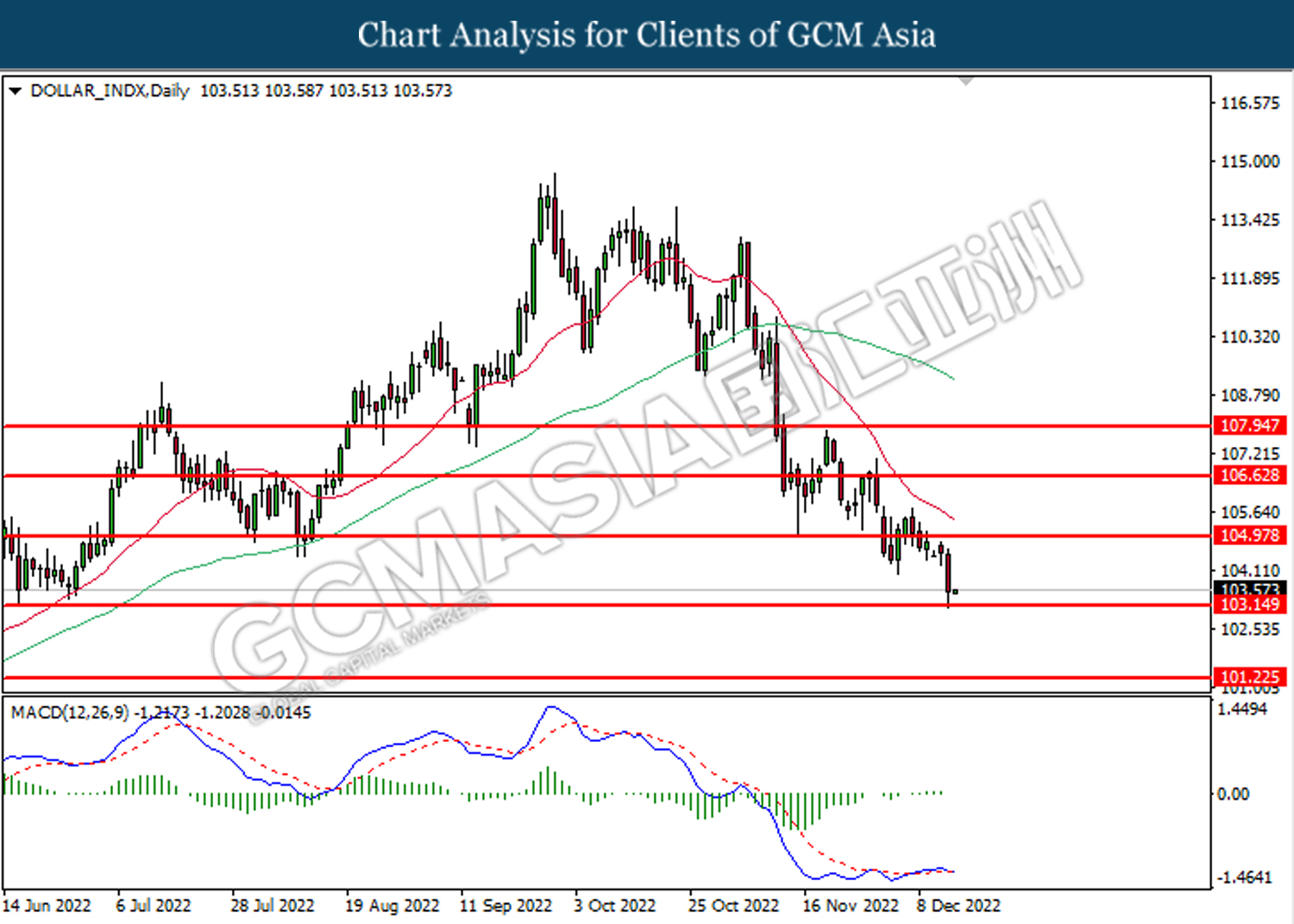

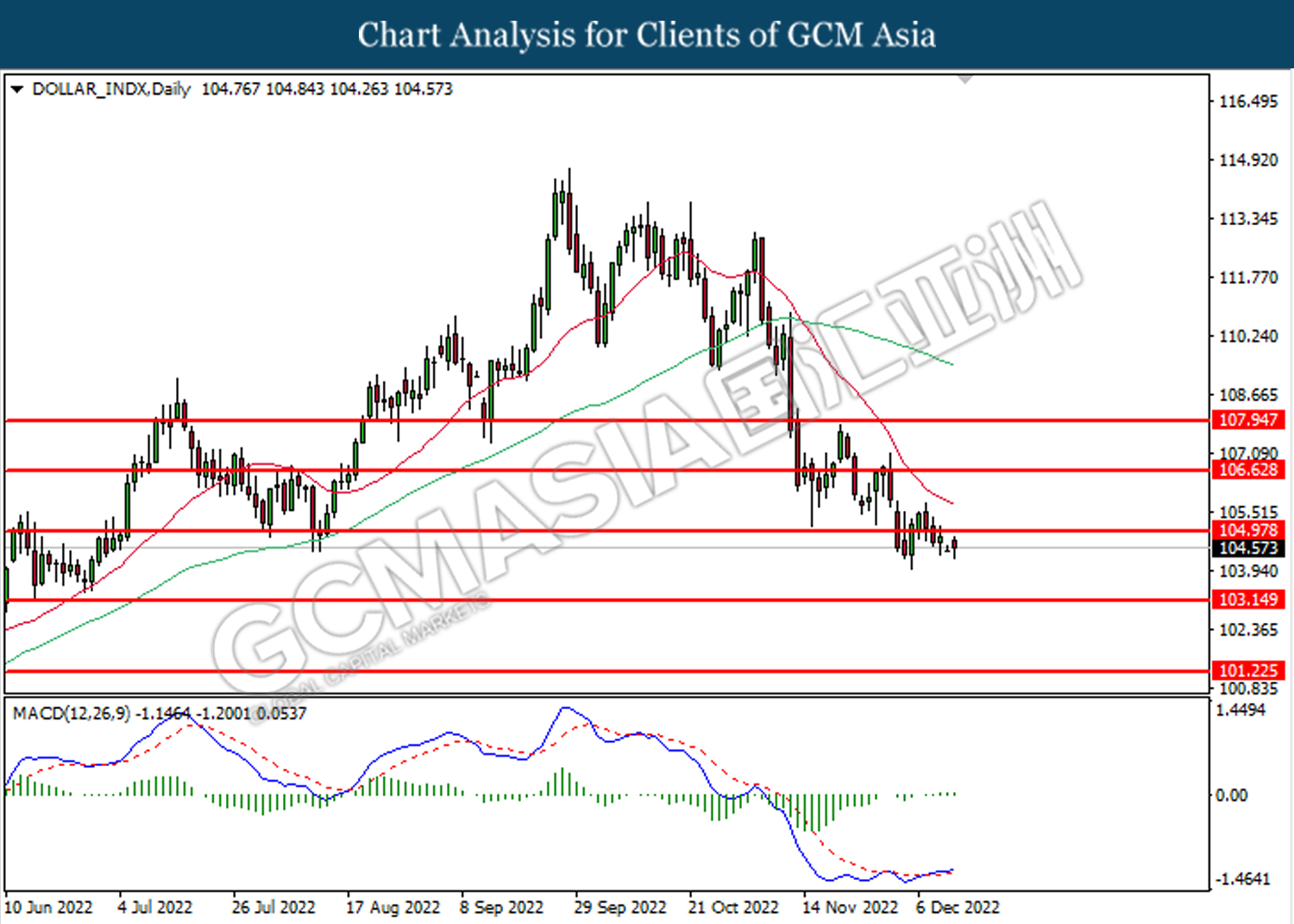

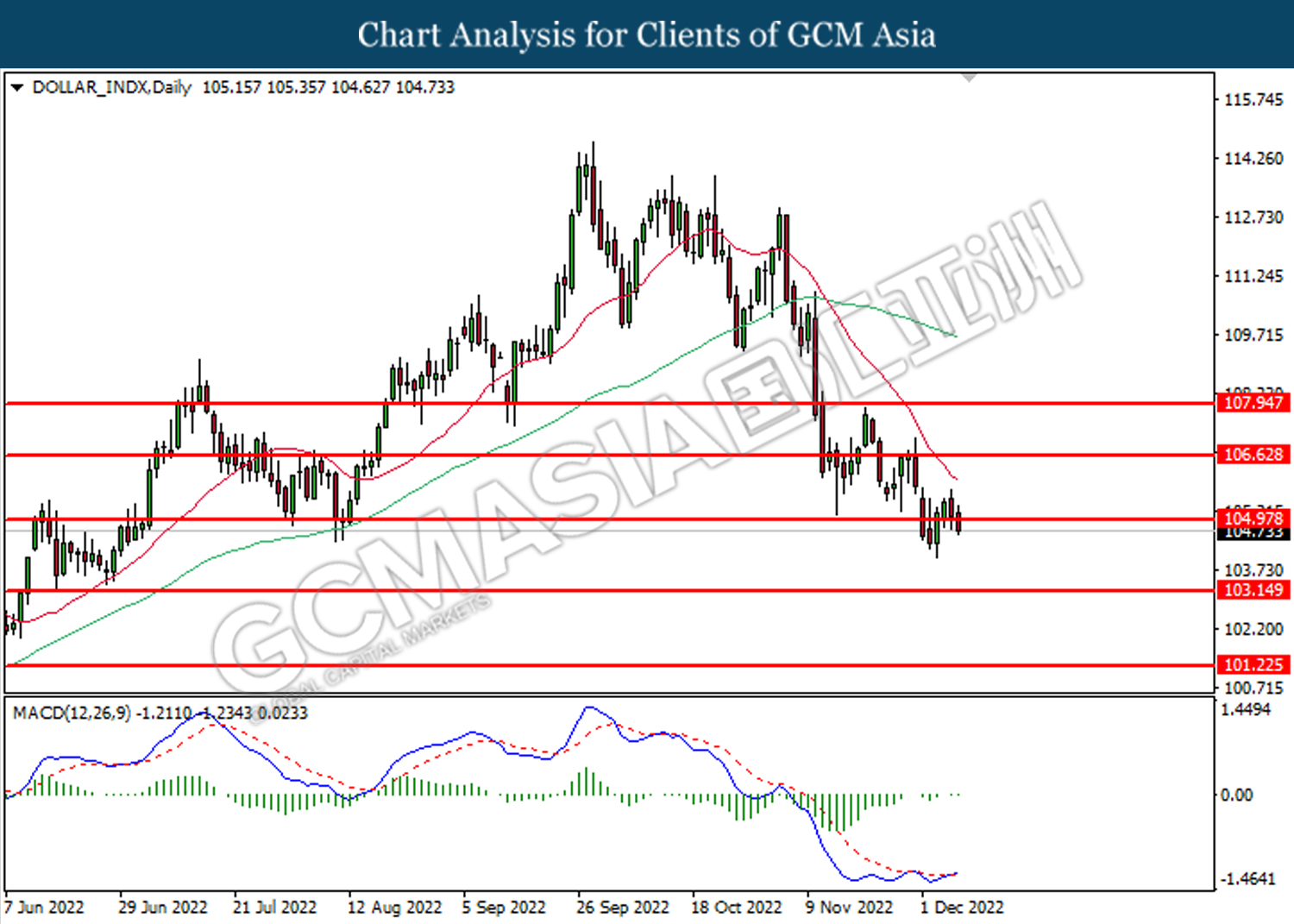

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

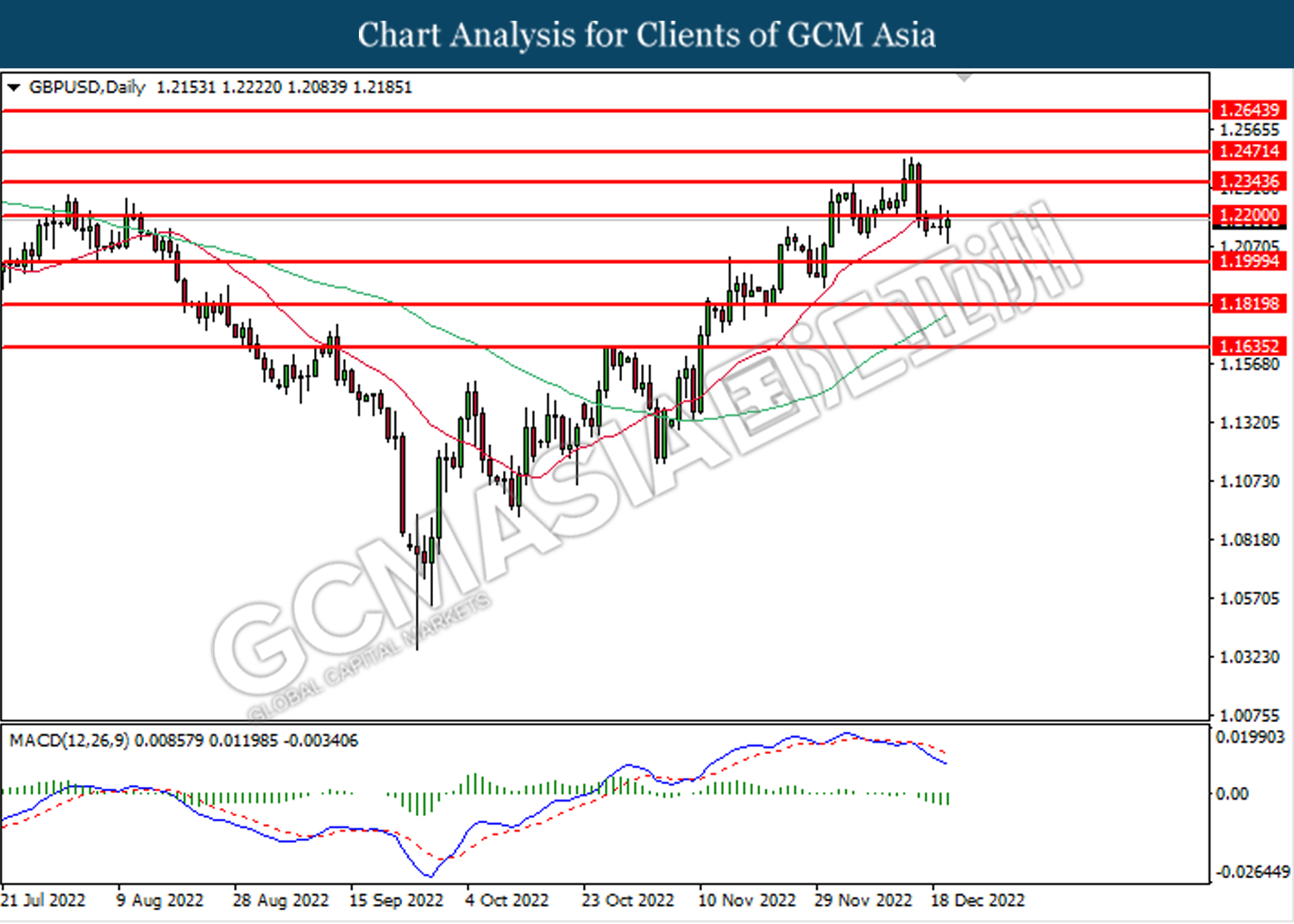

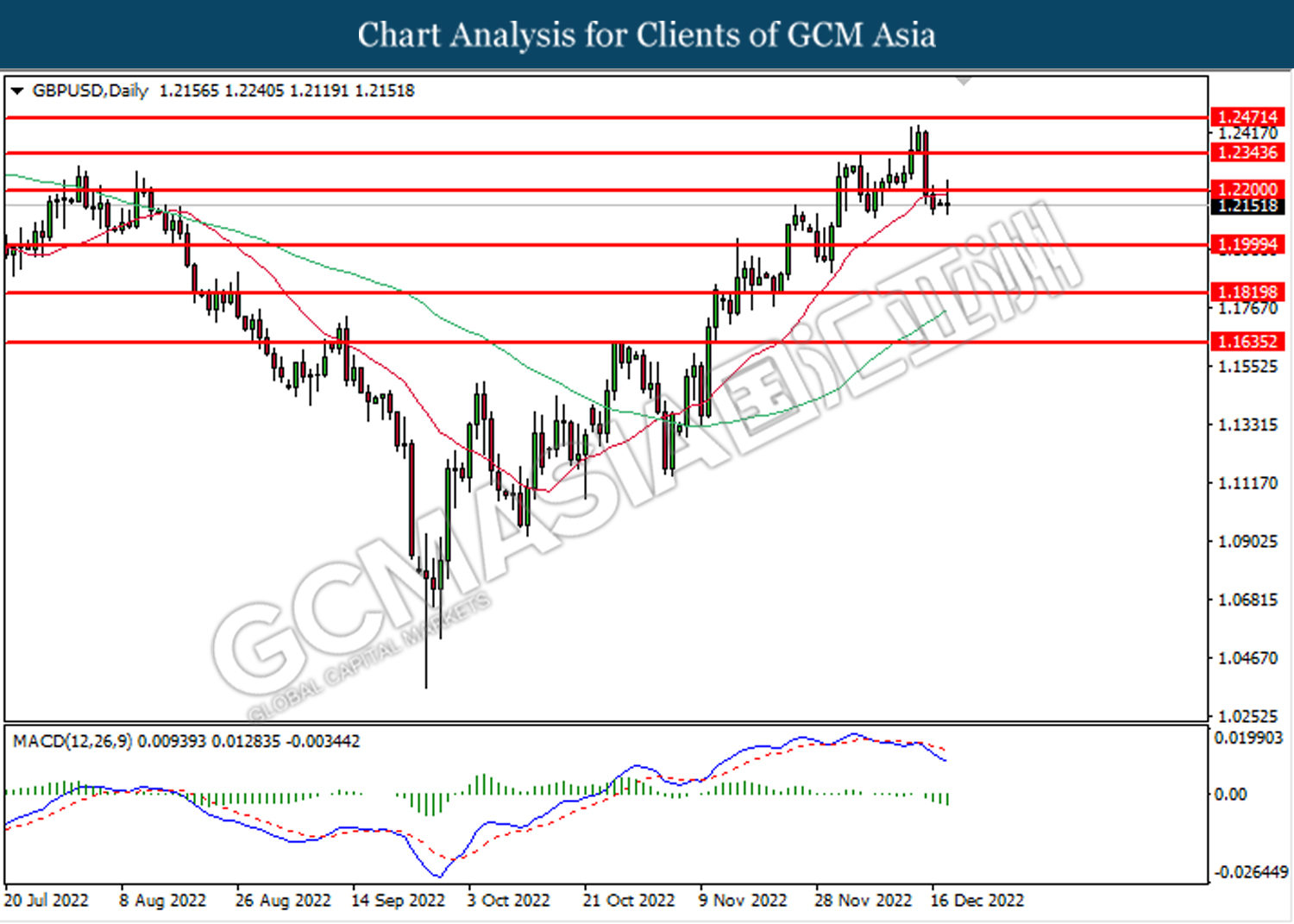

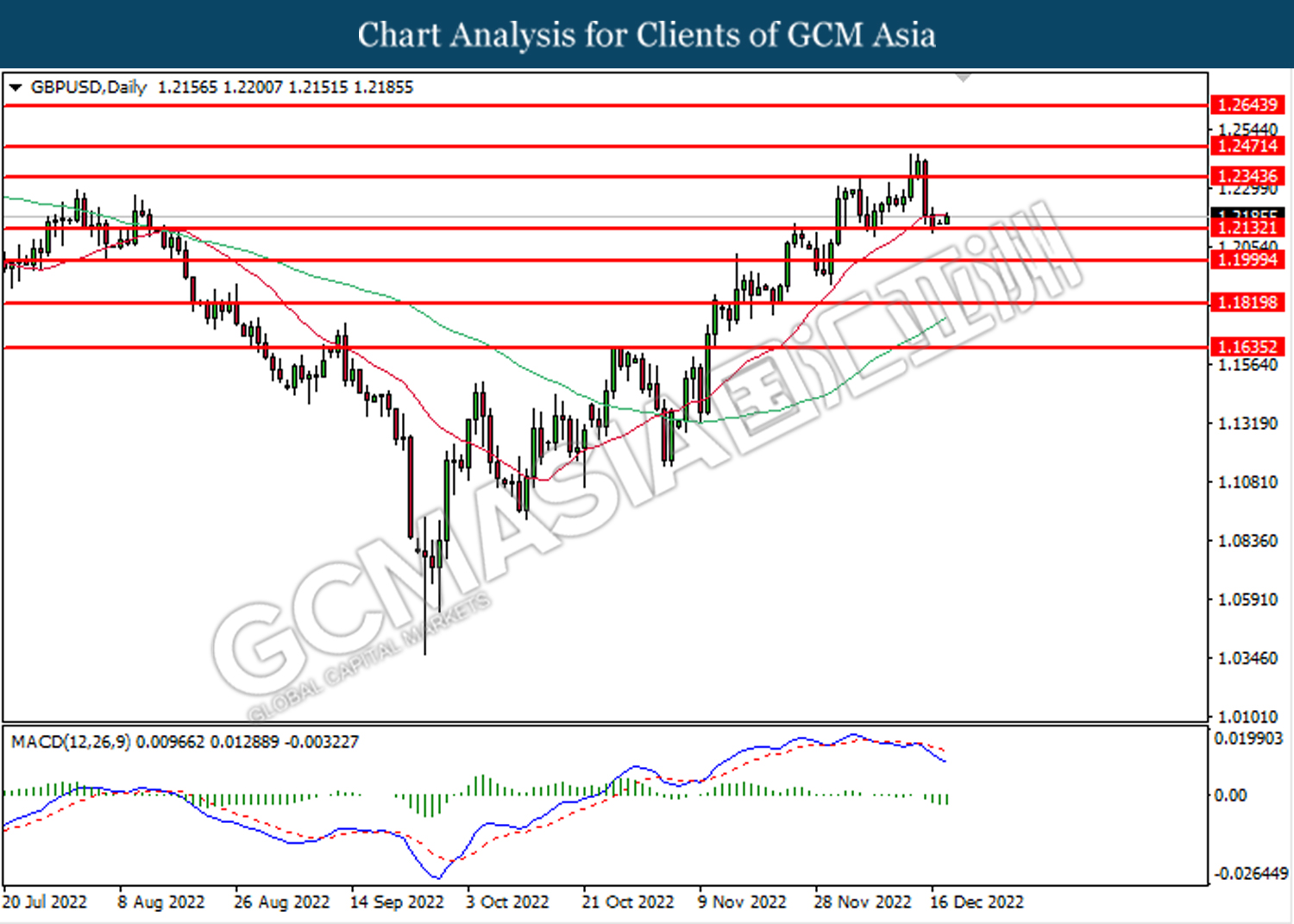

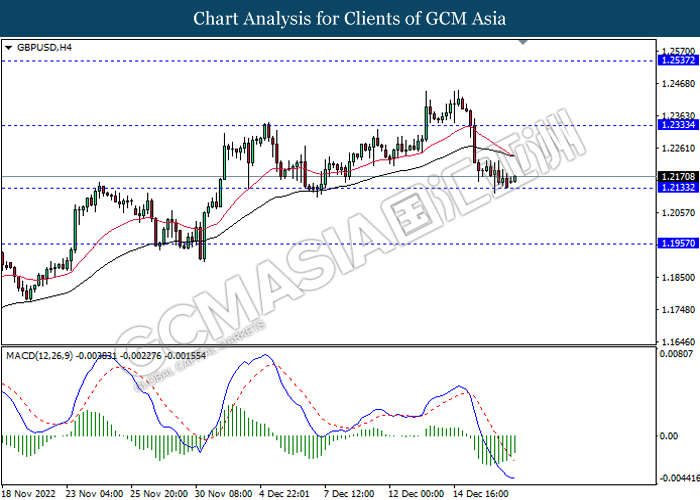

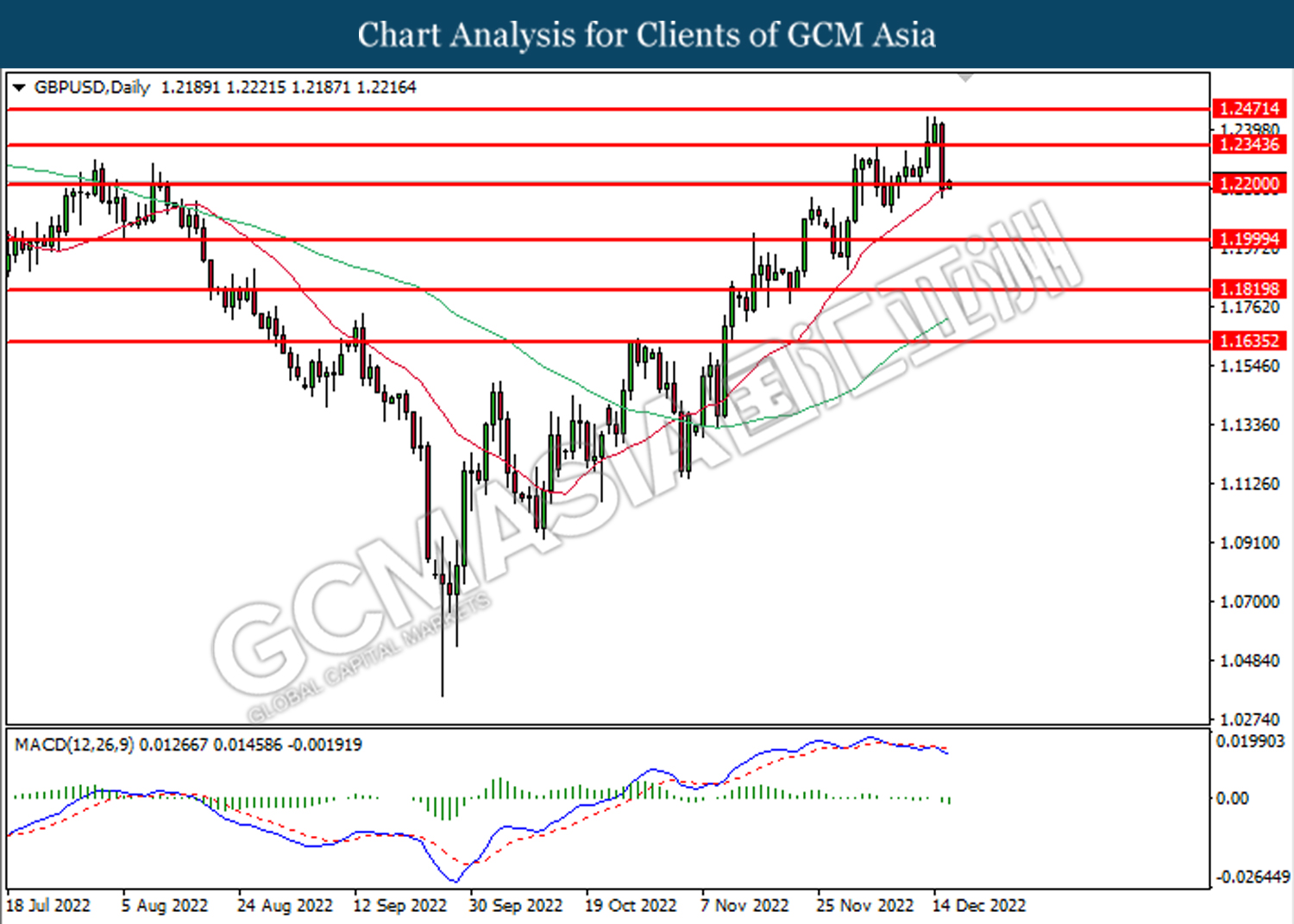

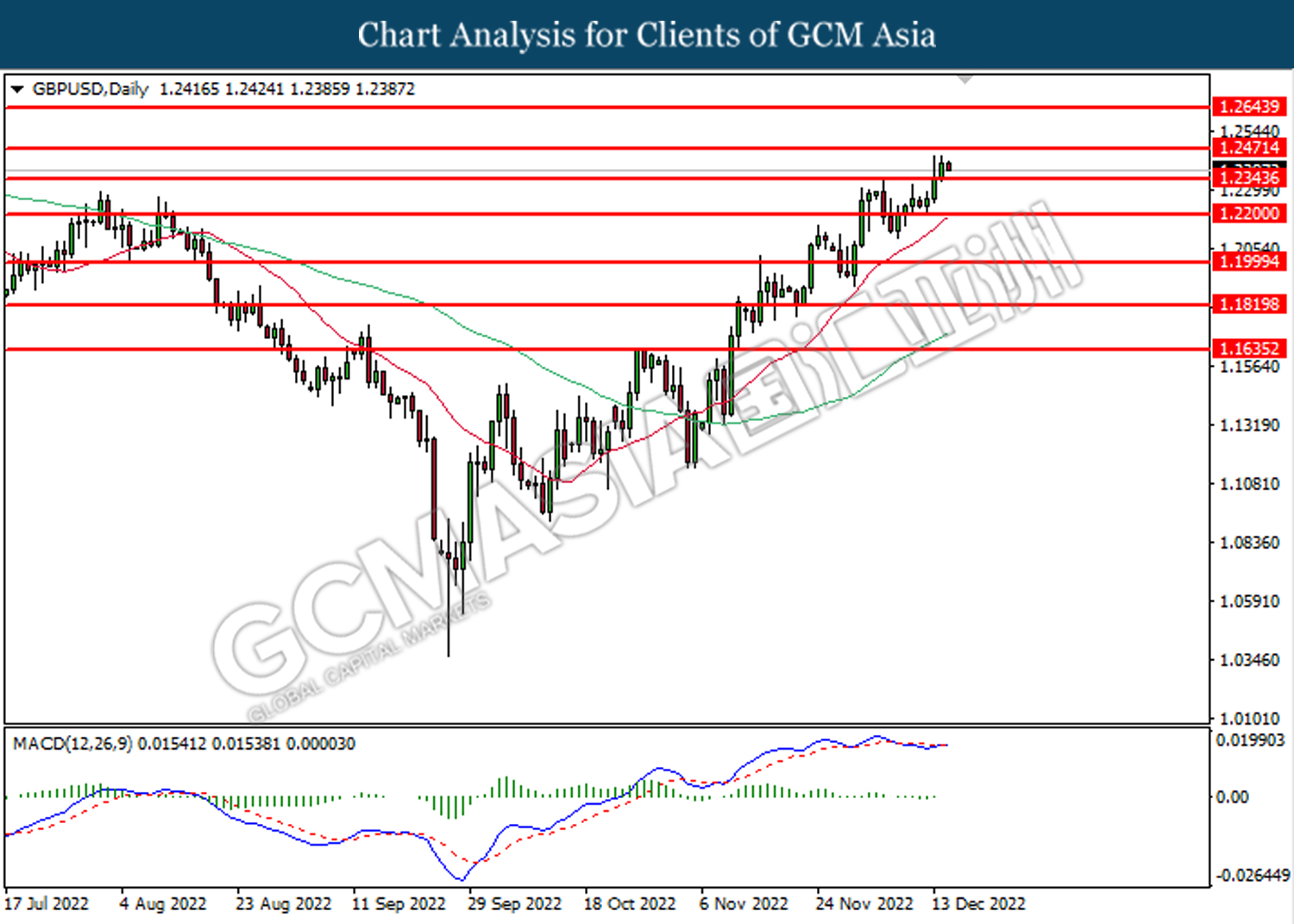

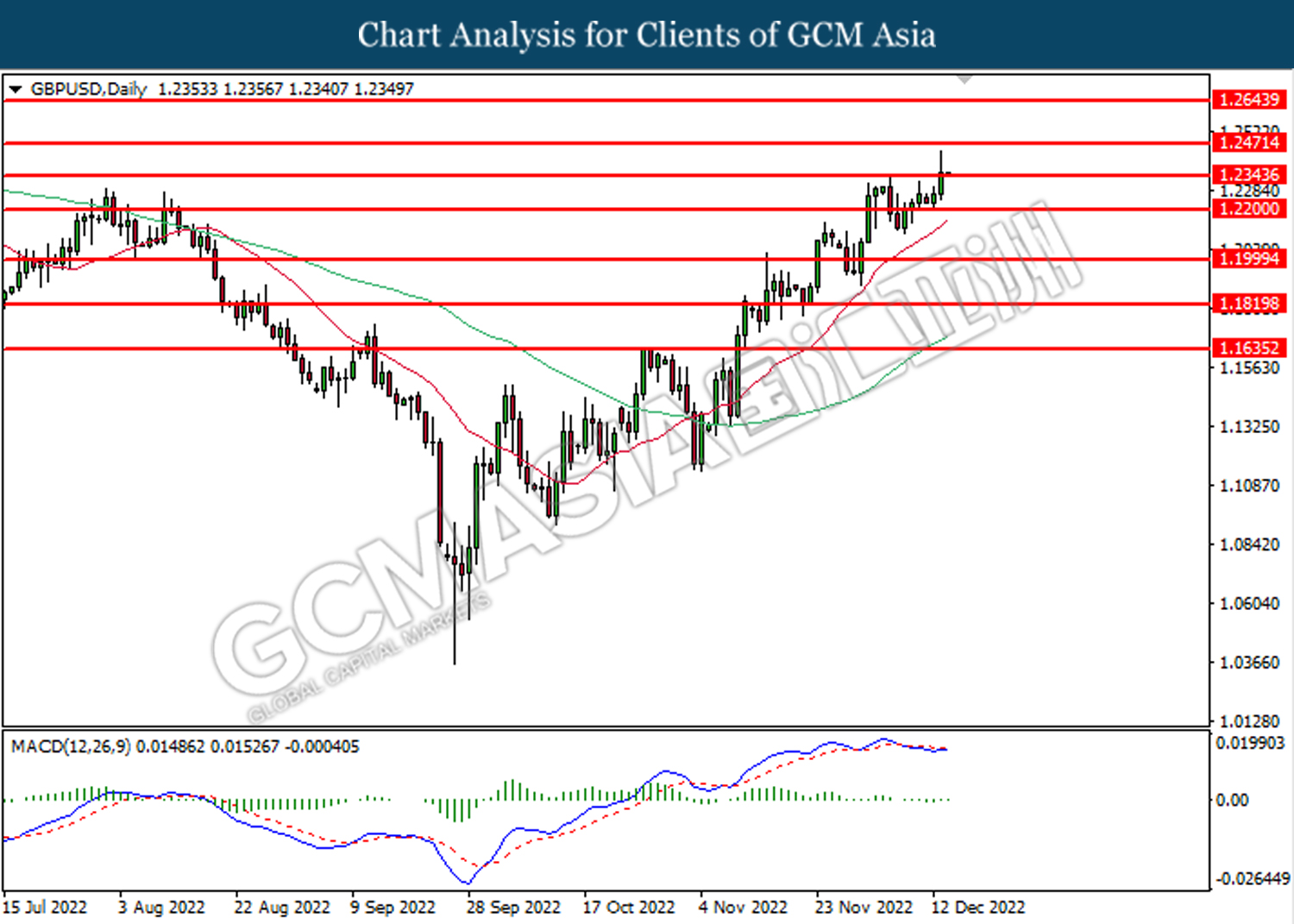

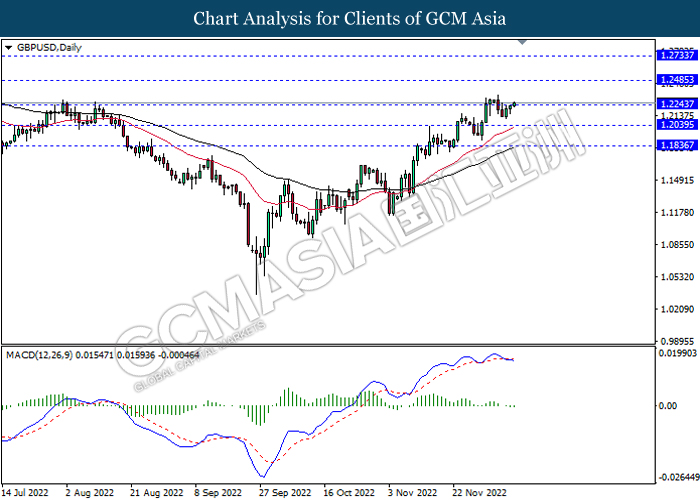

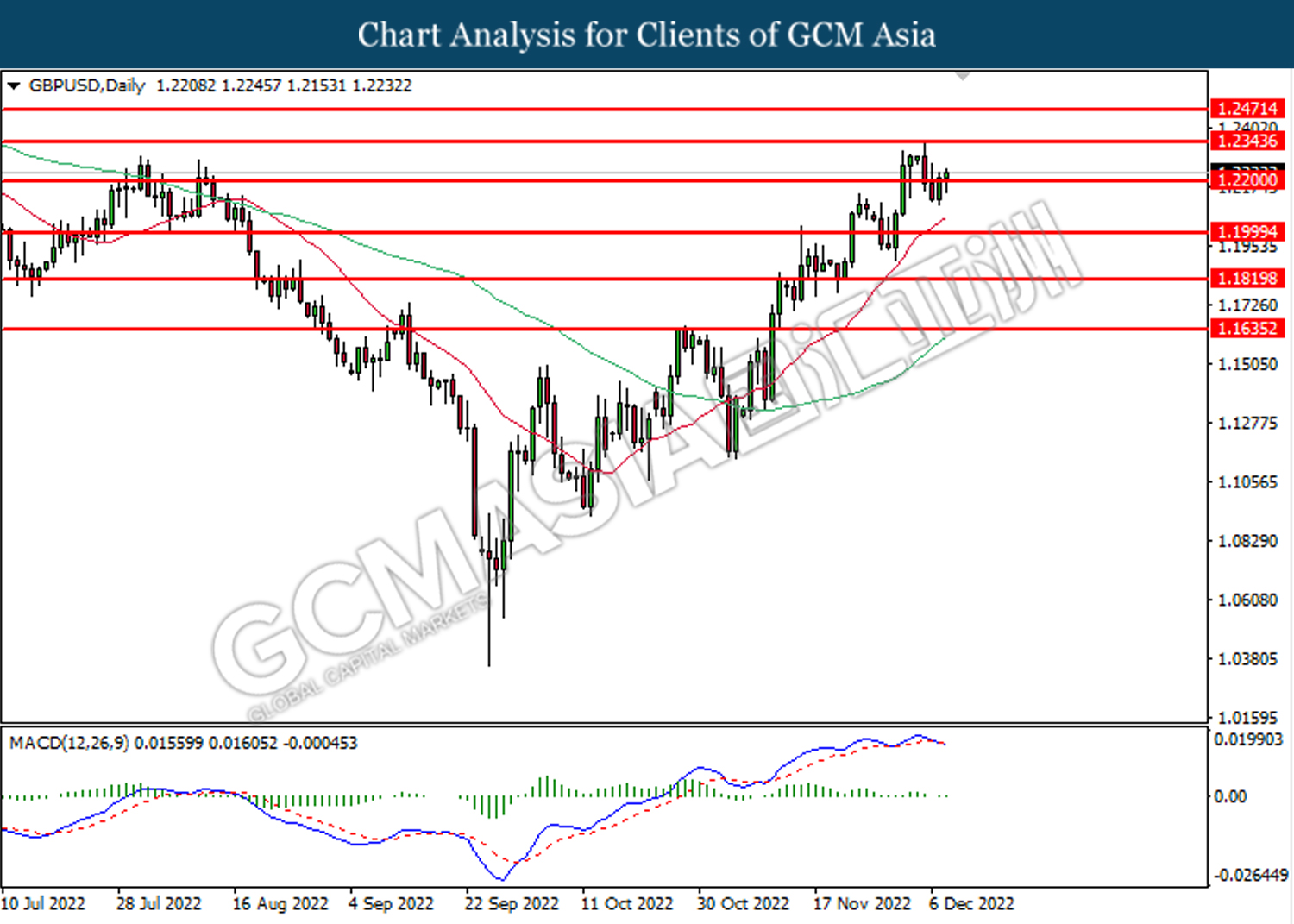

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

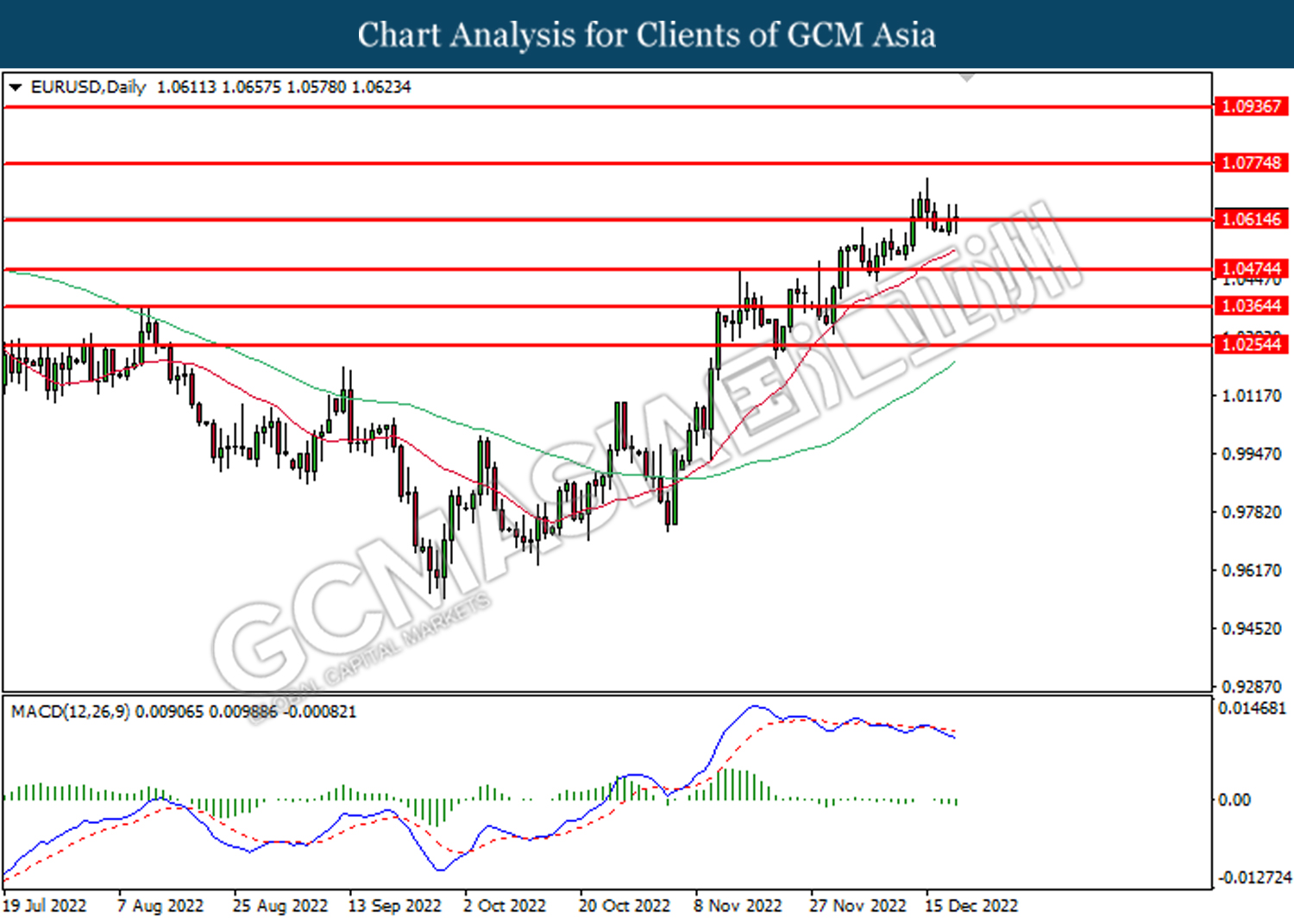

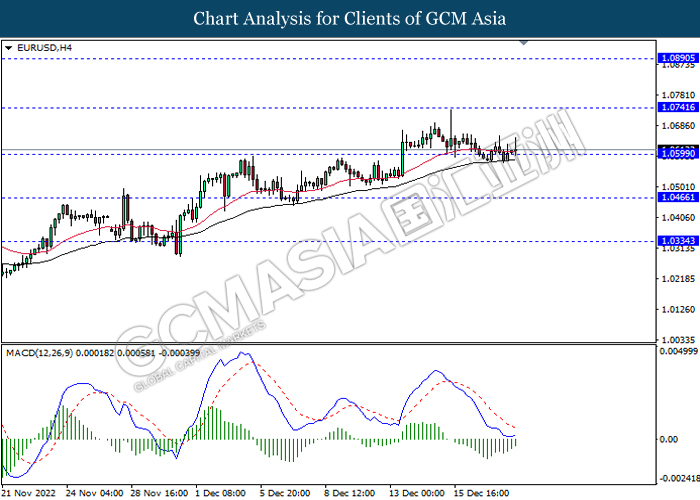

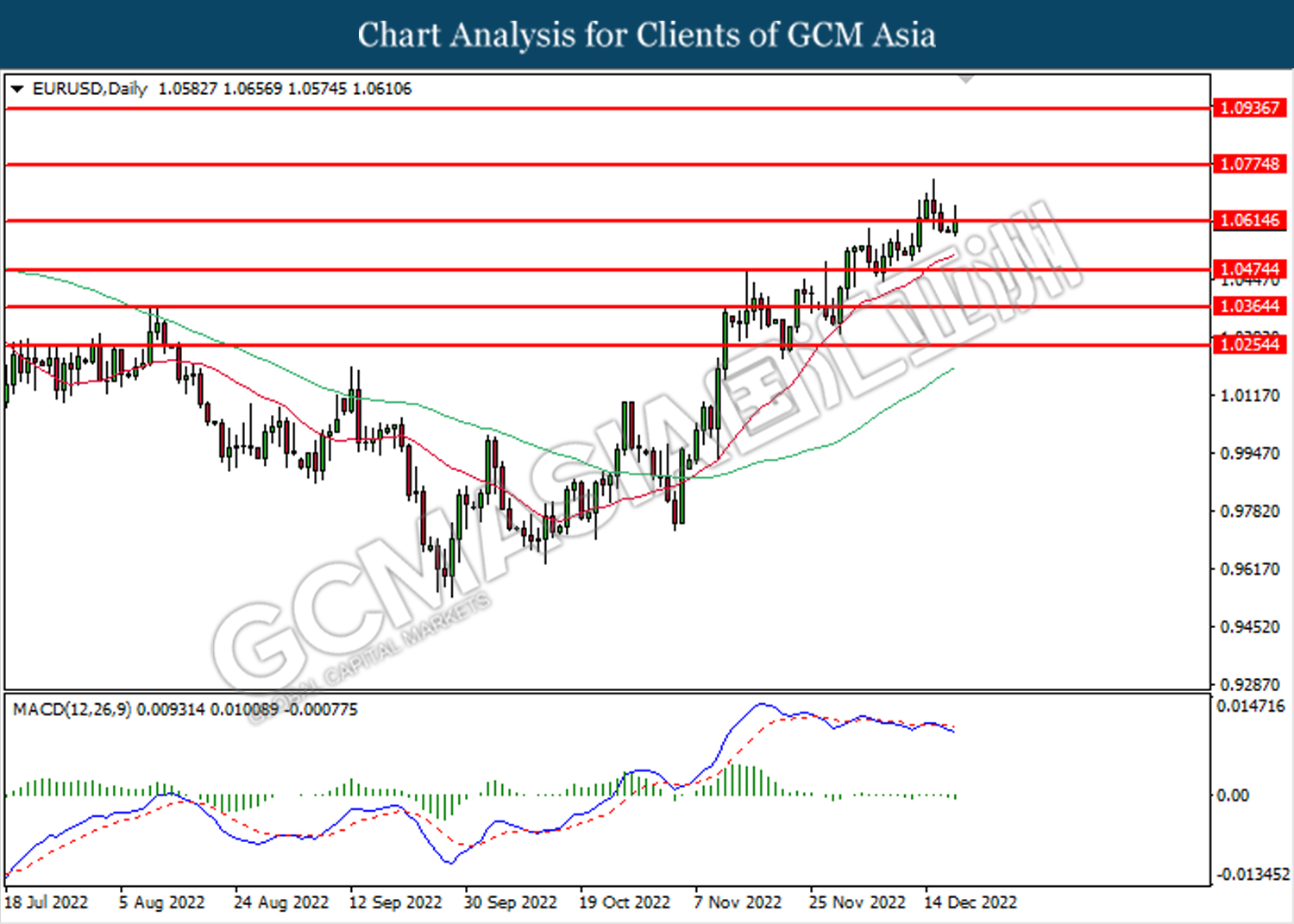

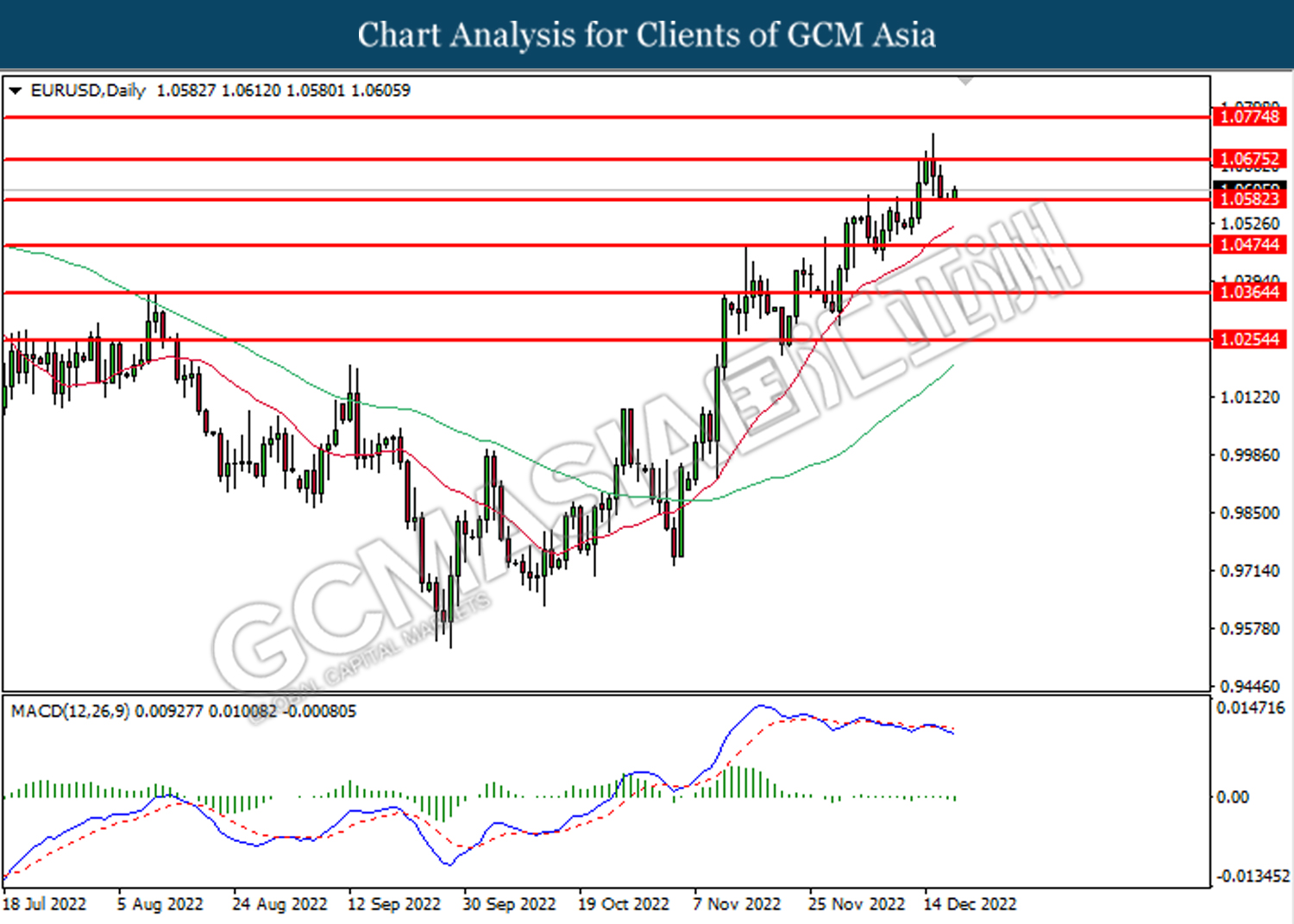

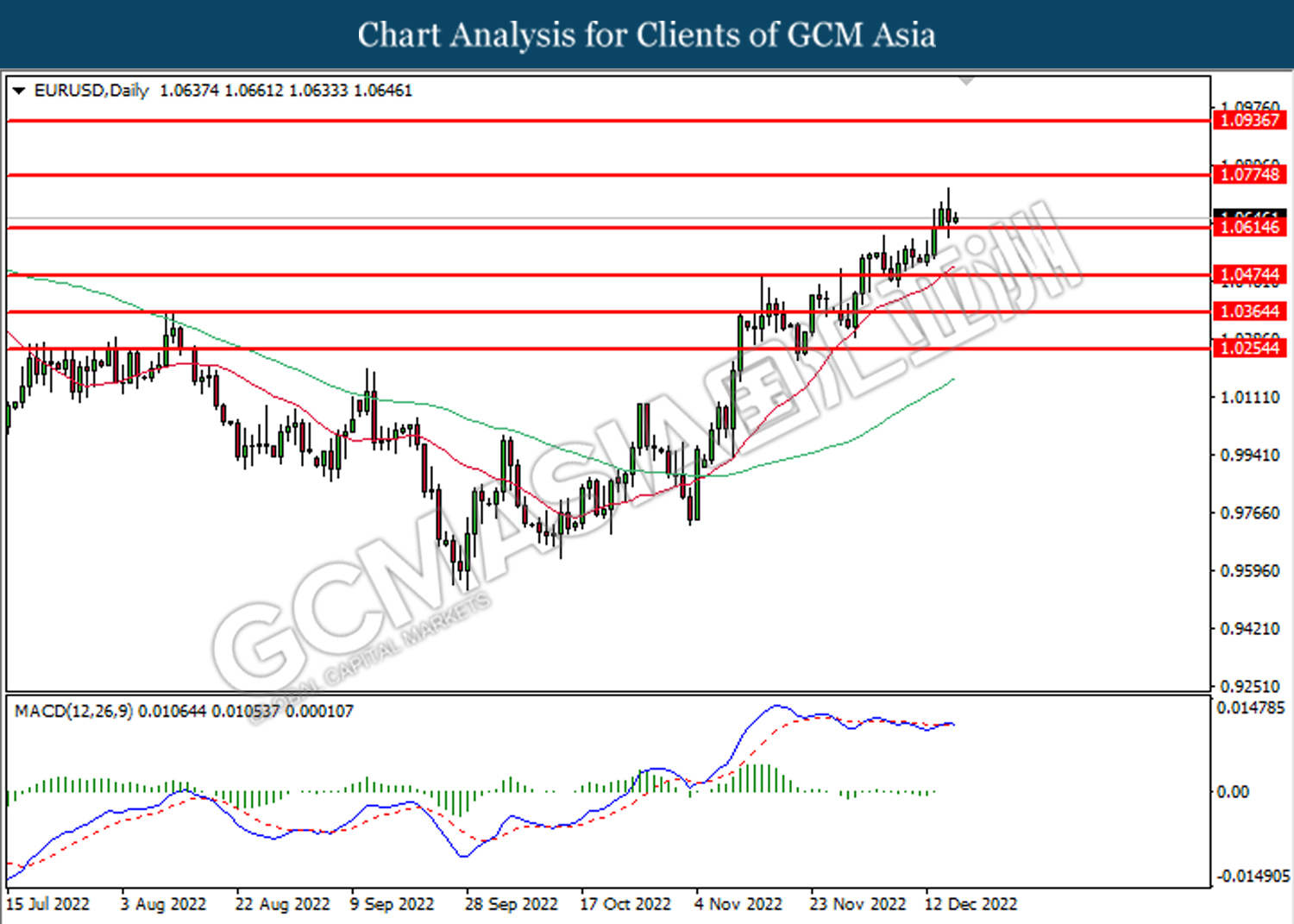

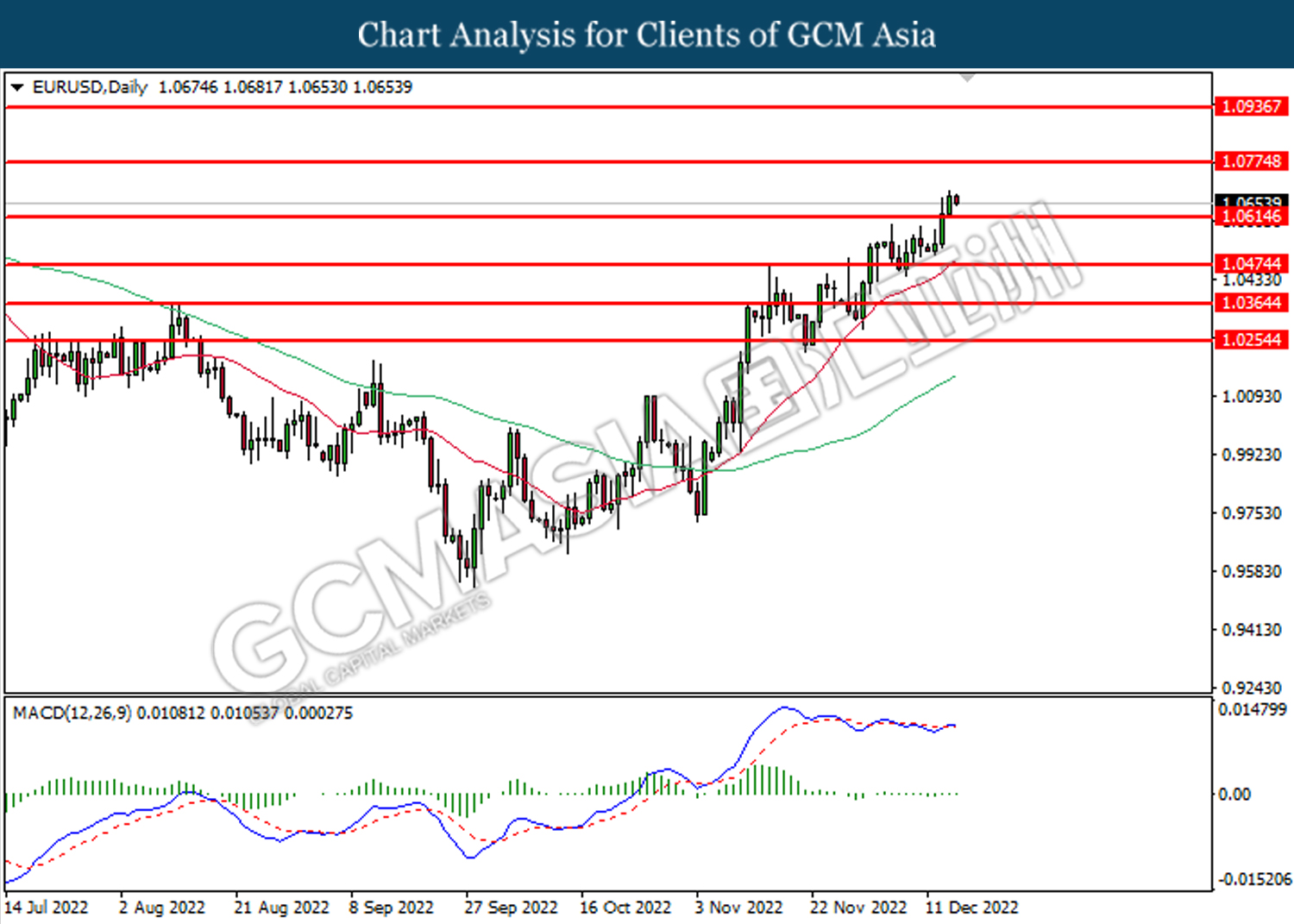

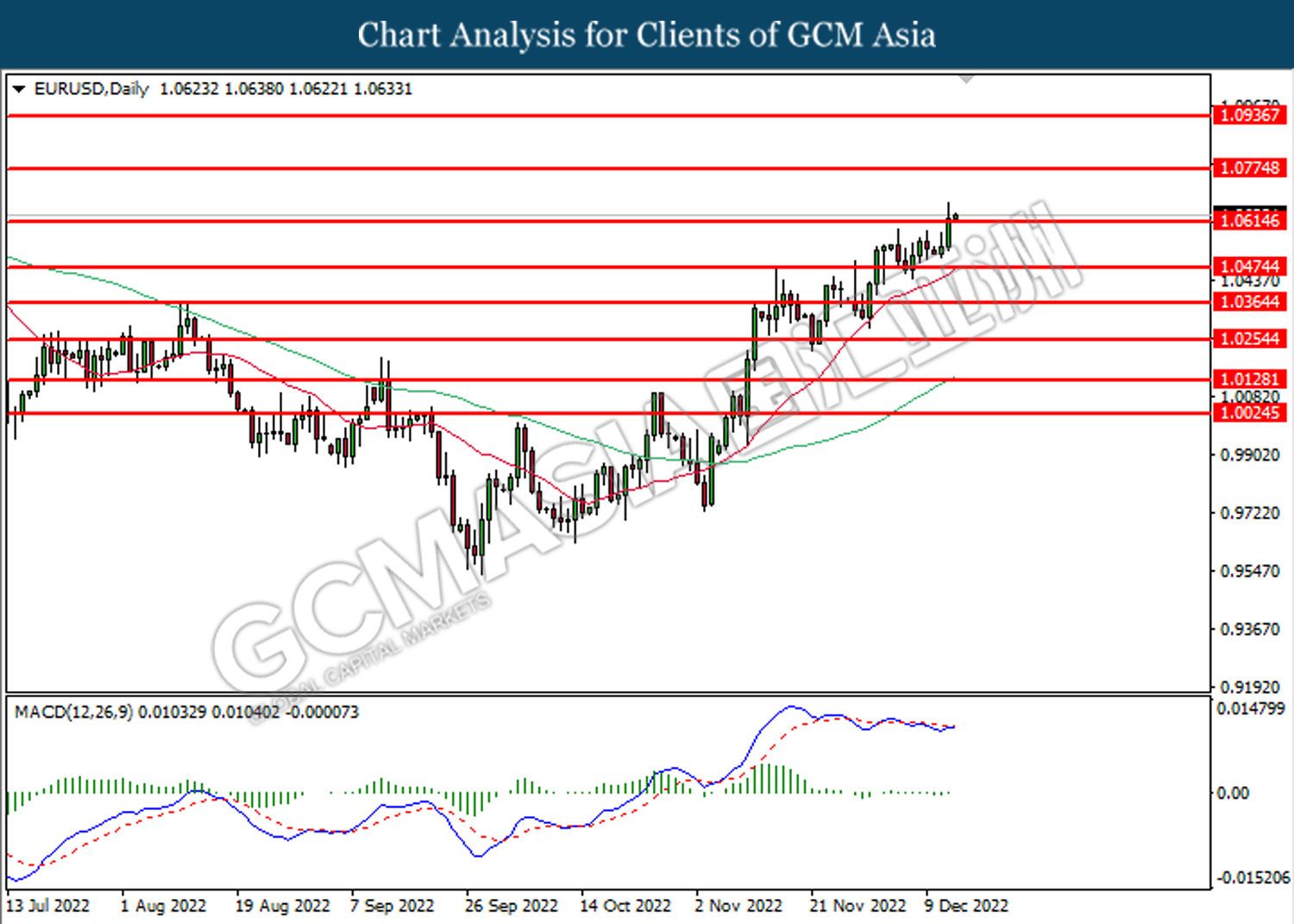

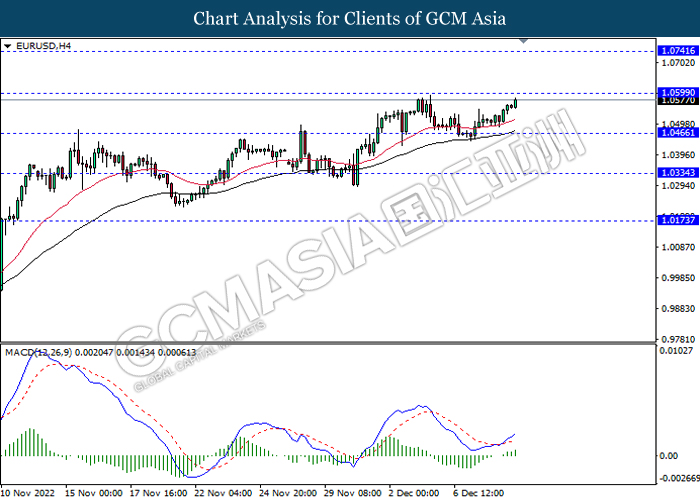

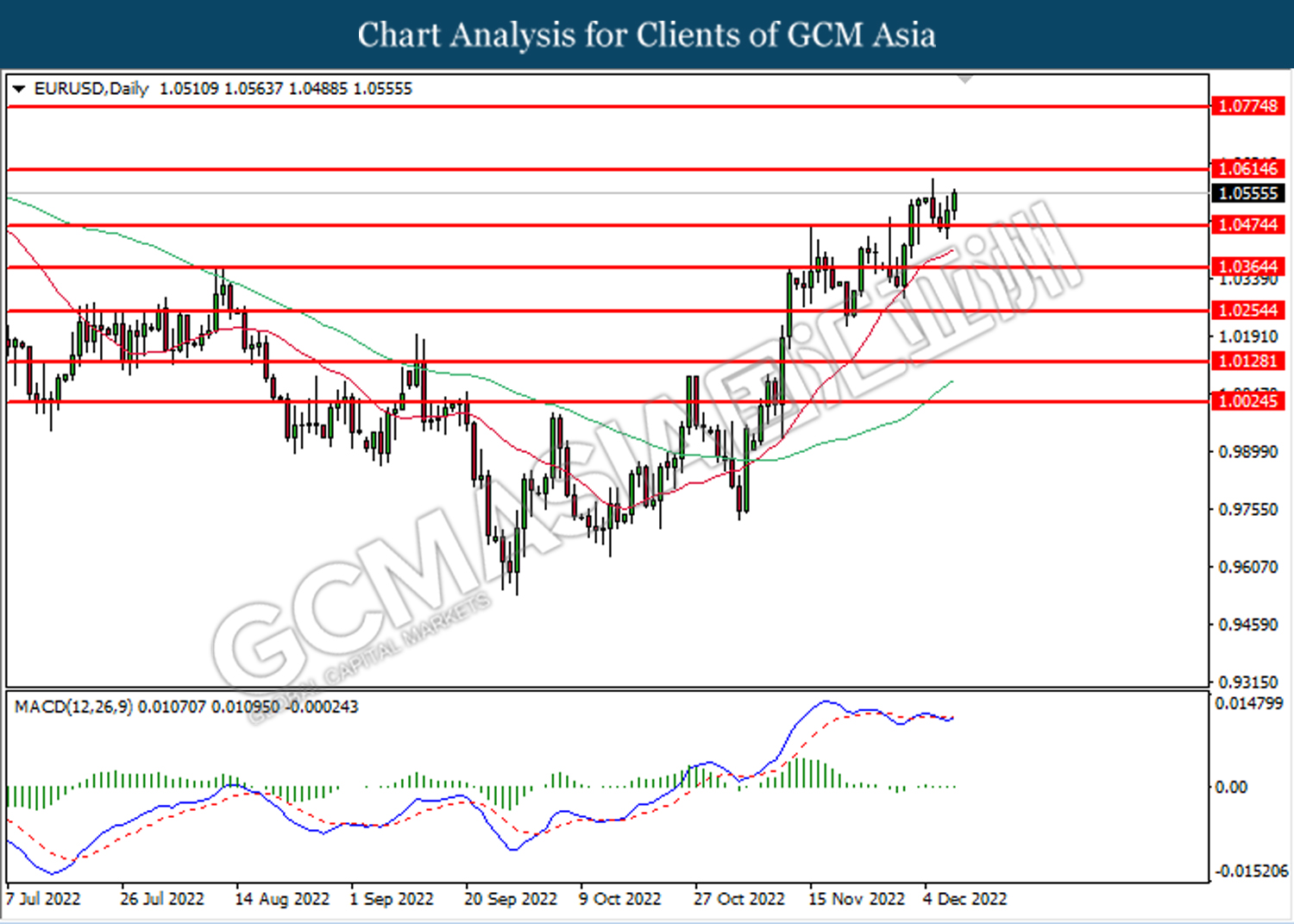

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0615. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

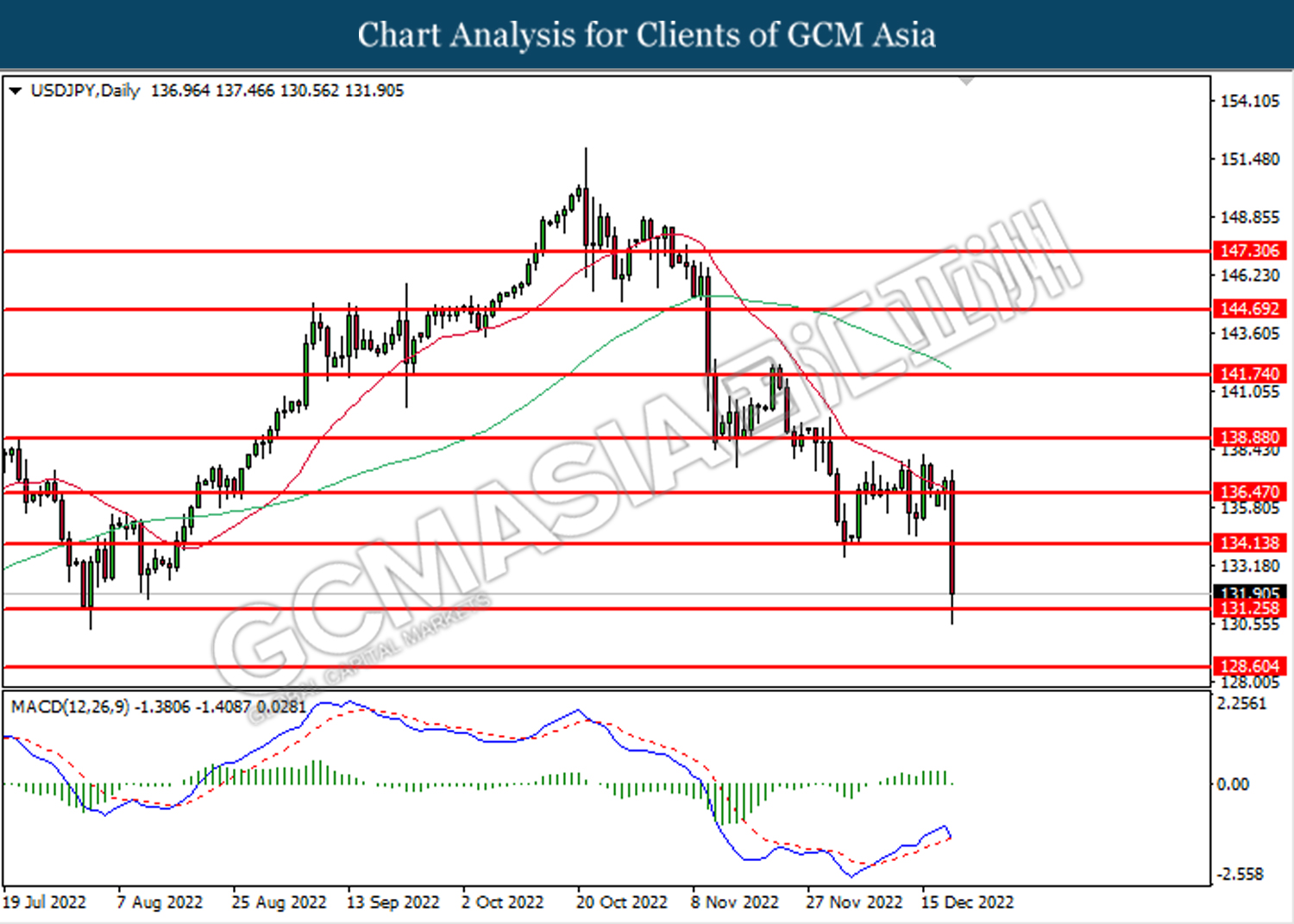

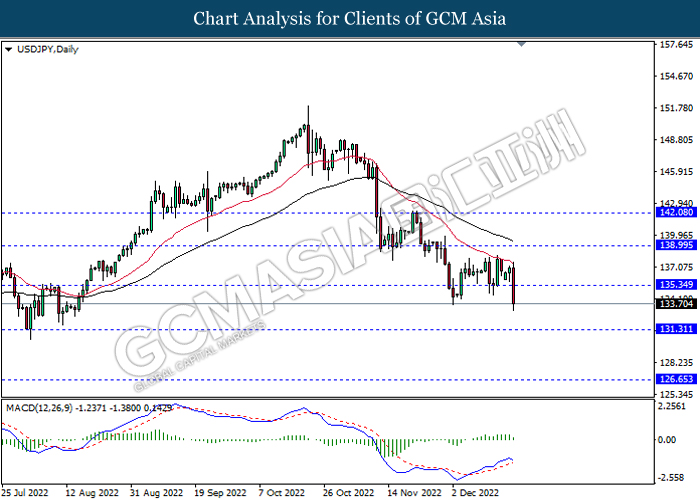

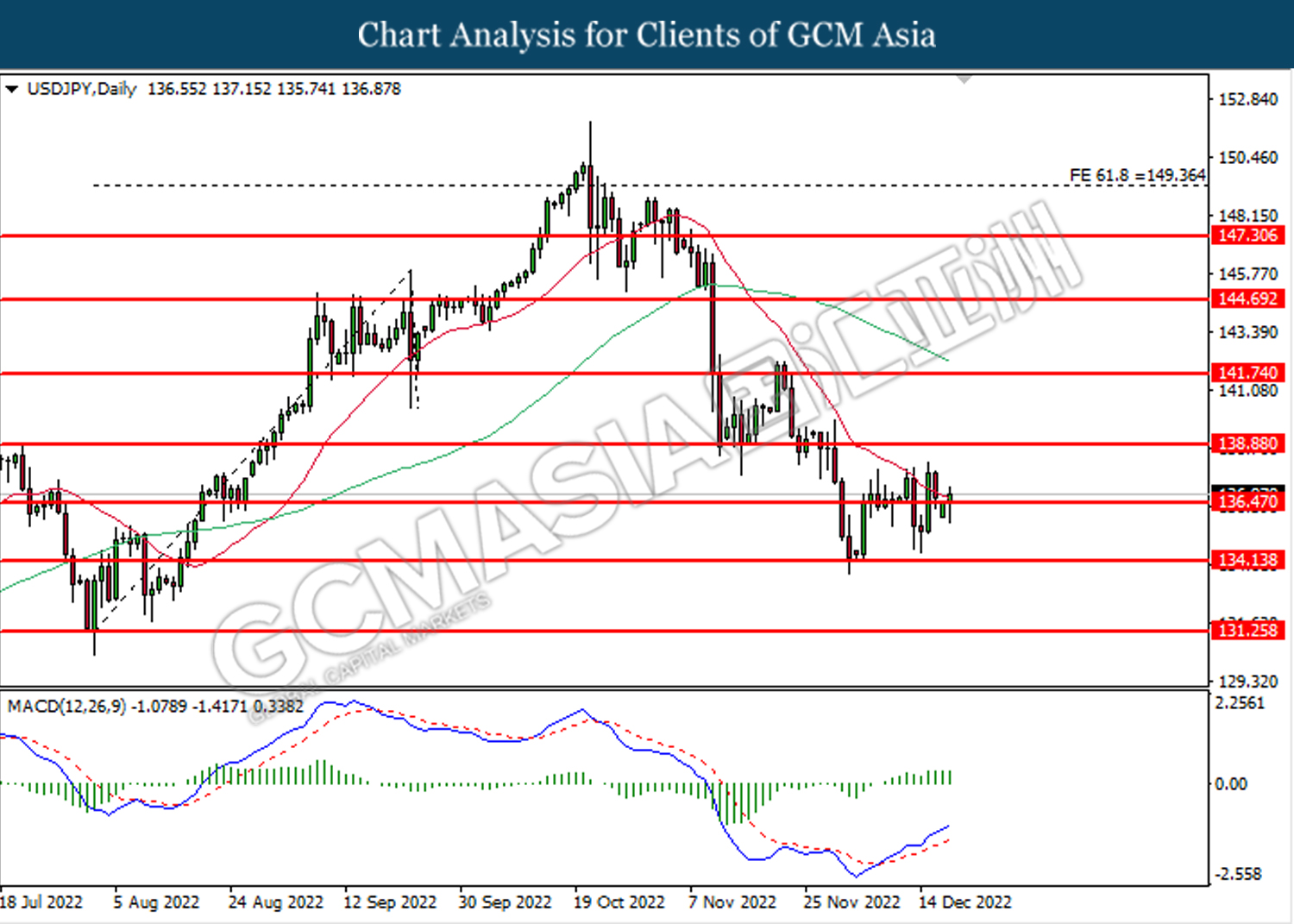

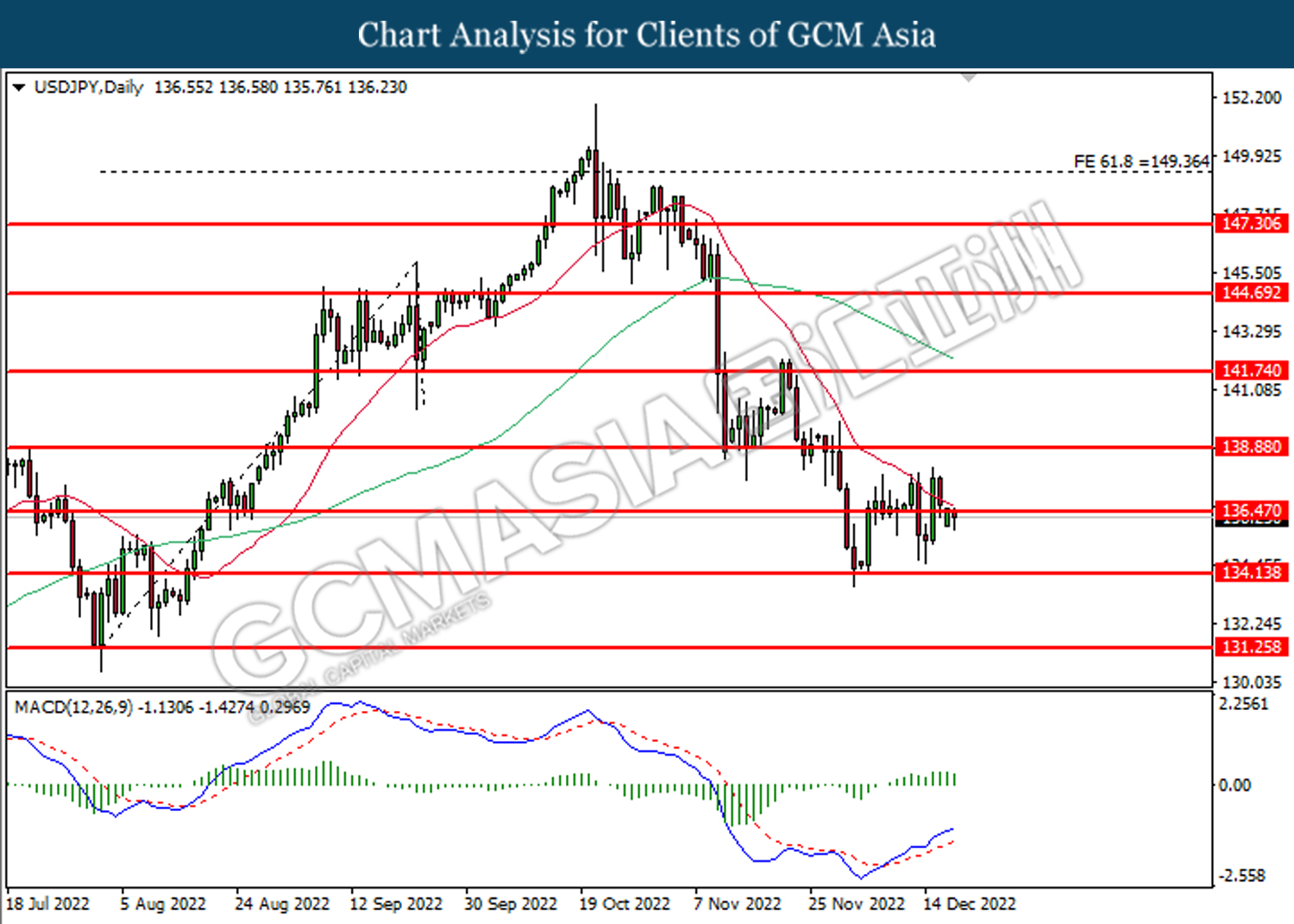

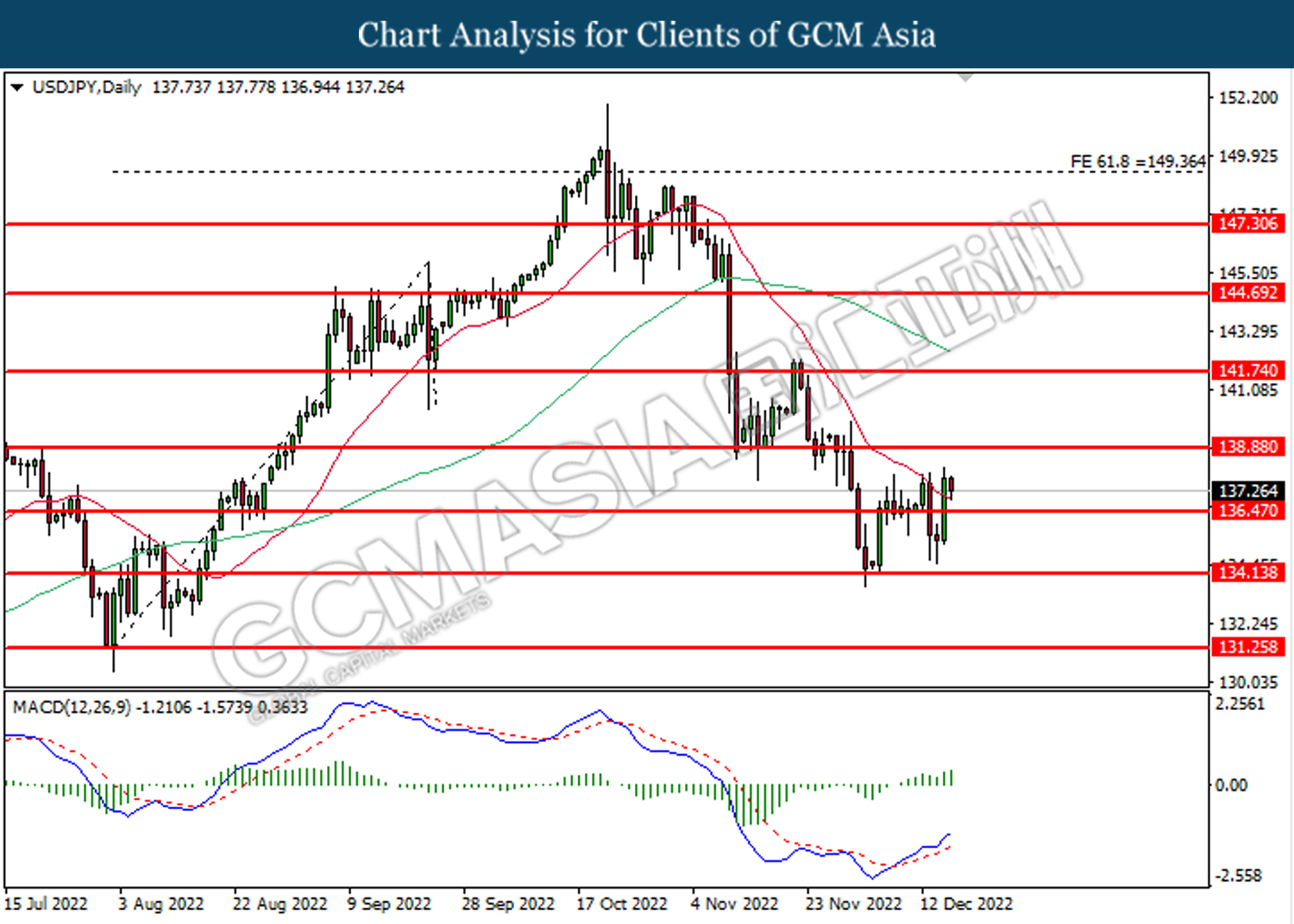

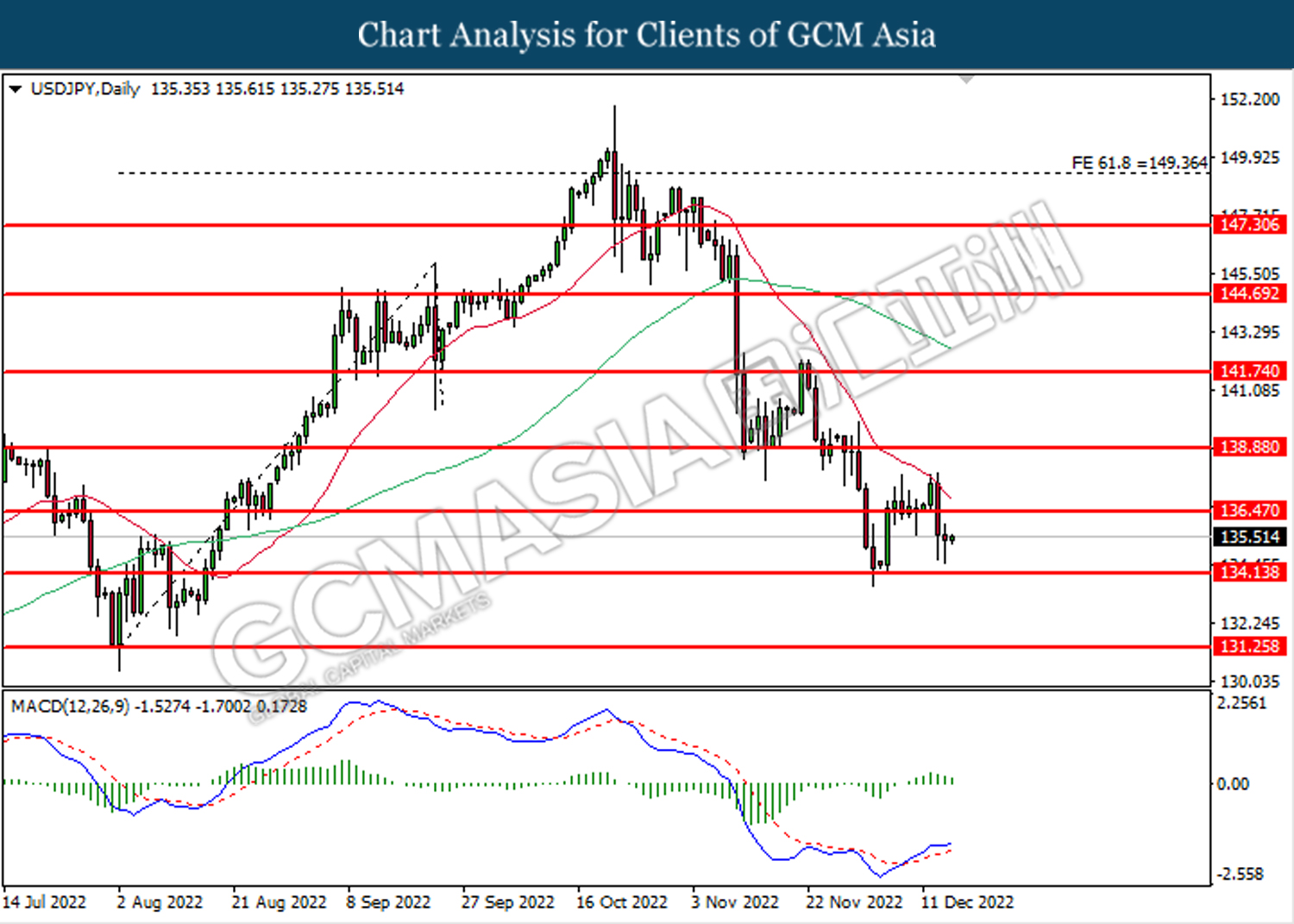

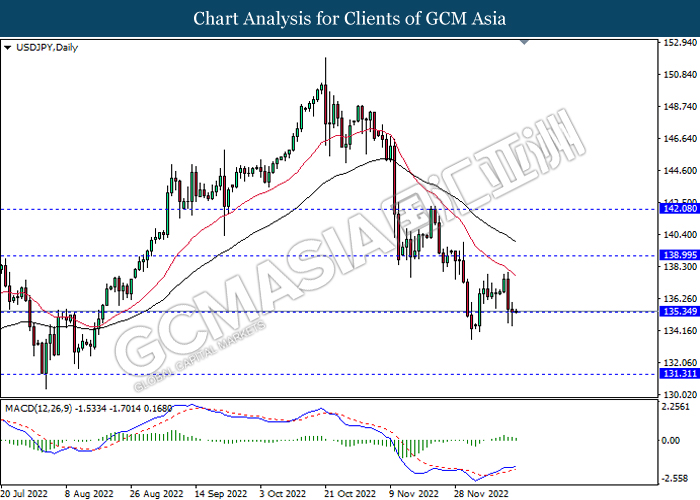

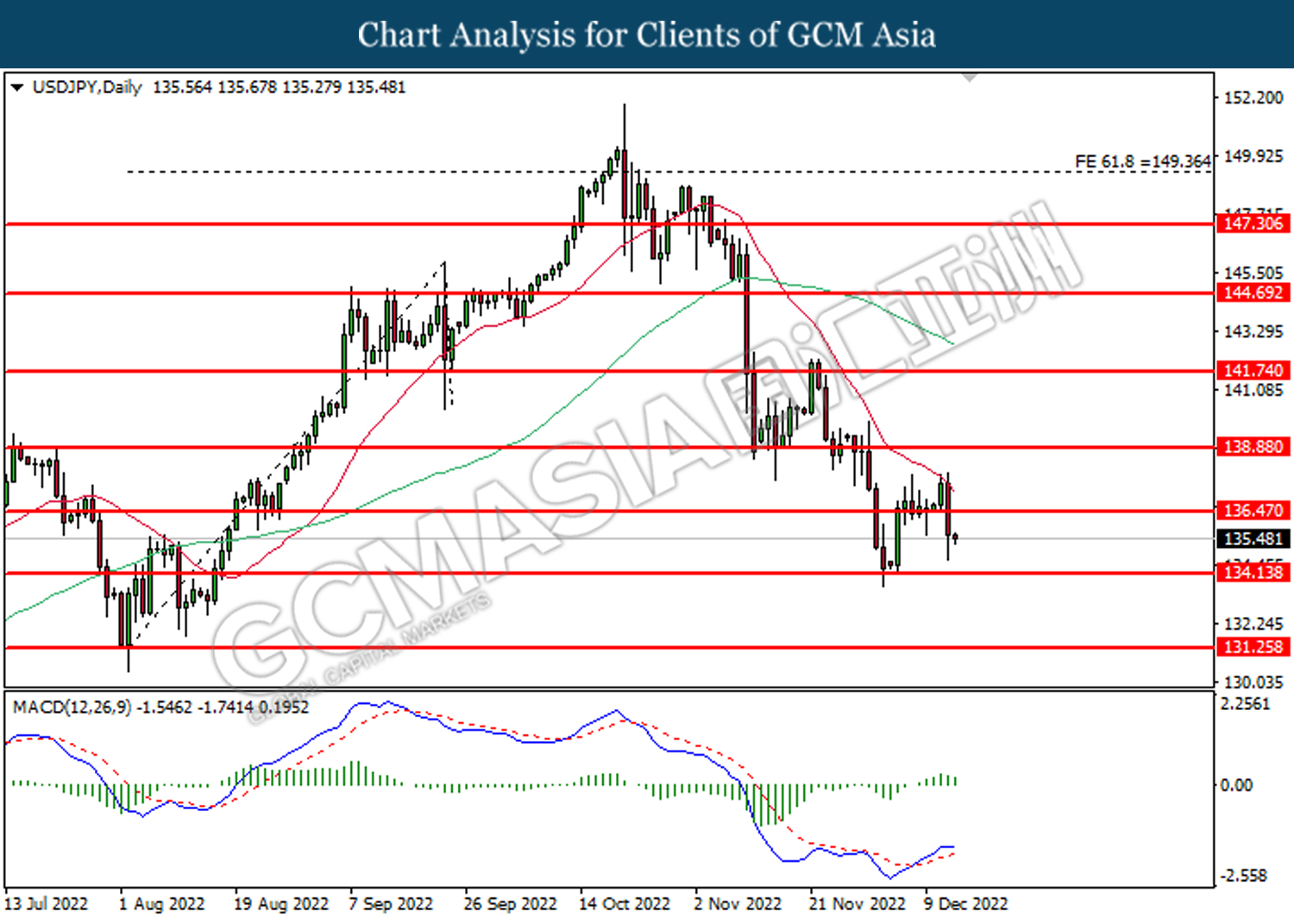

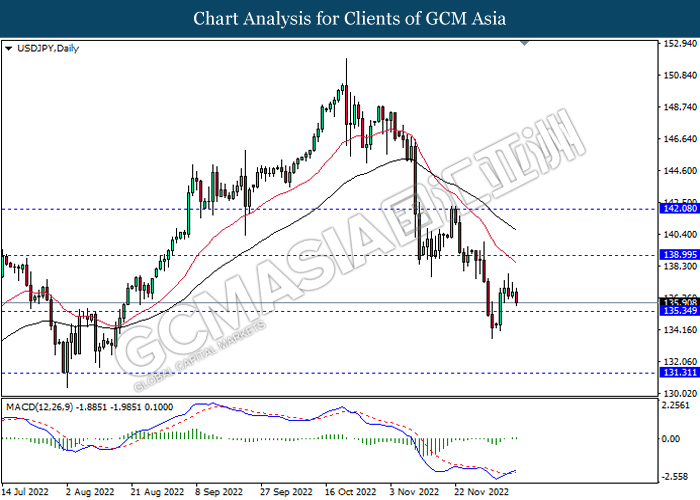

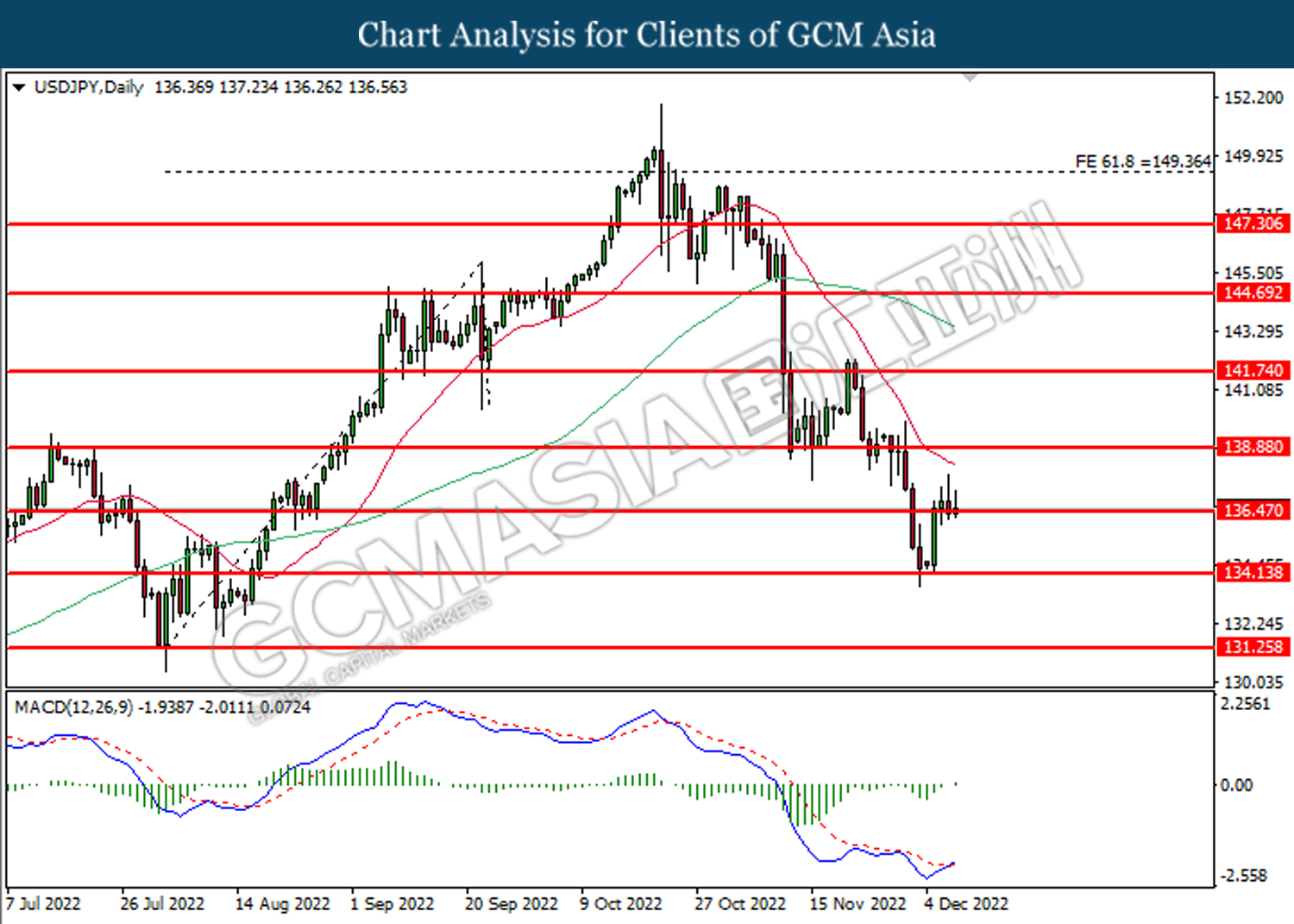

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

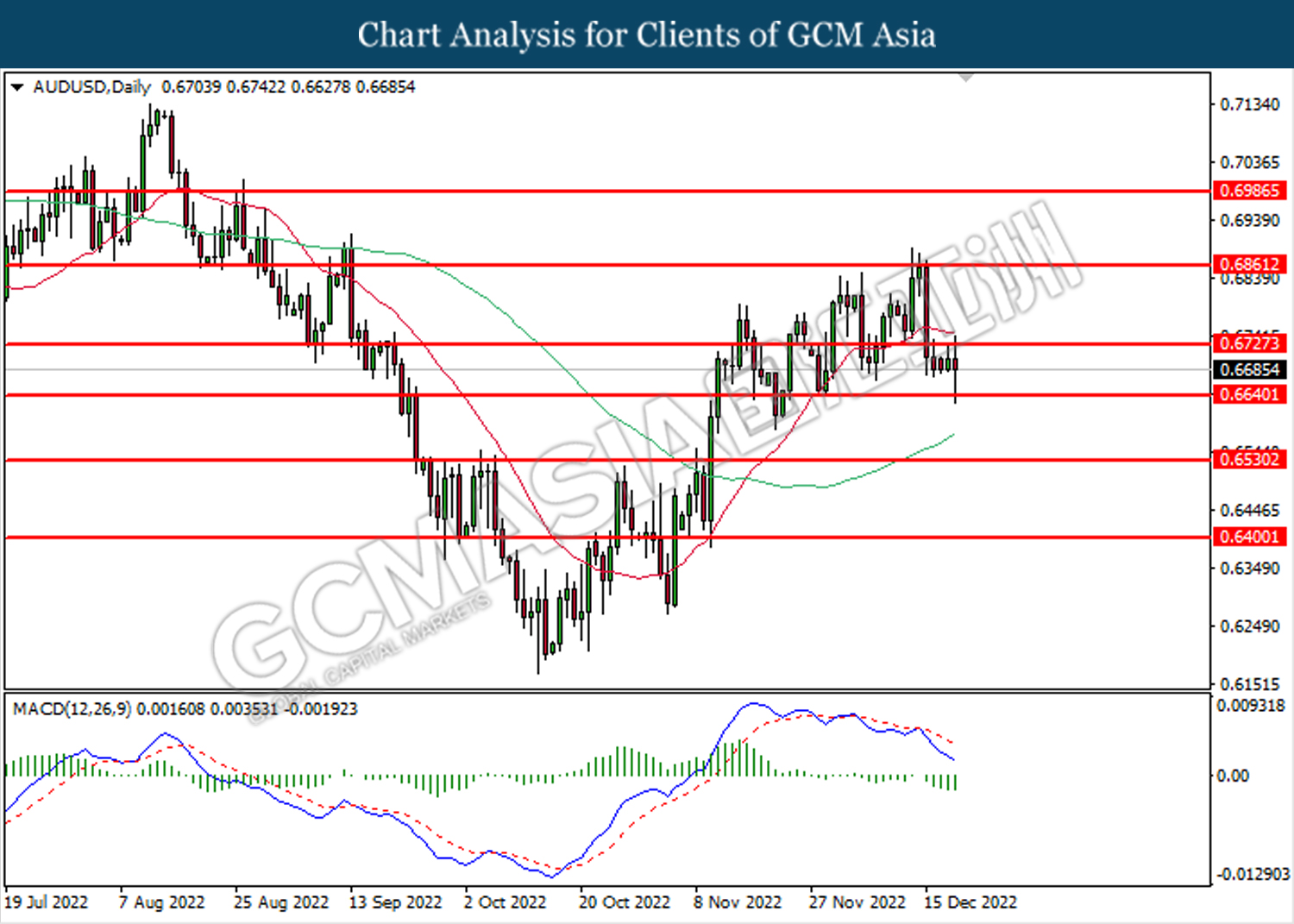

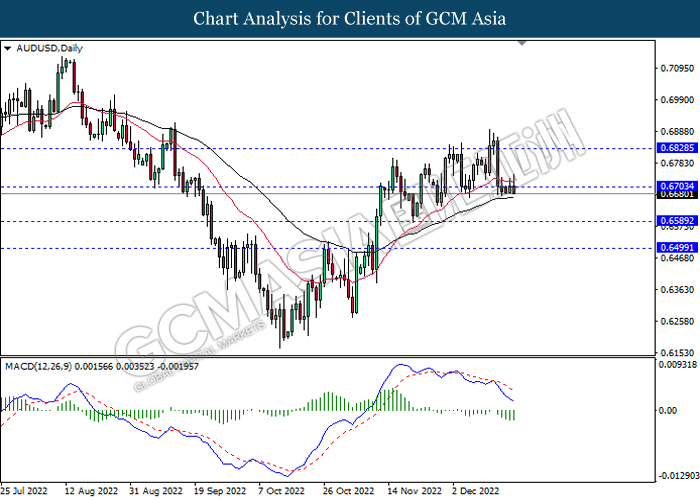

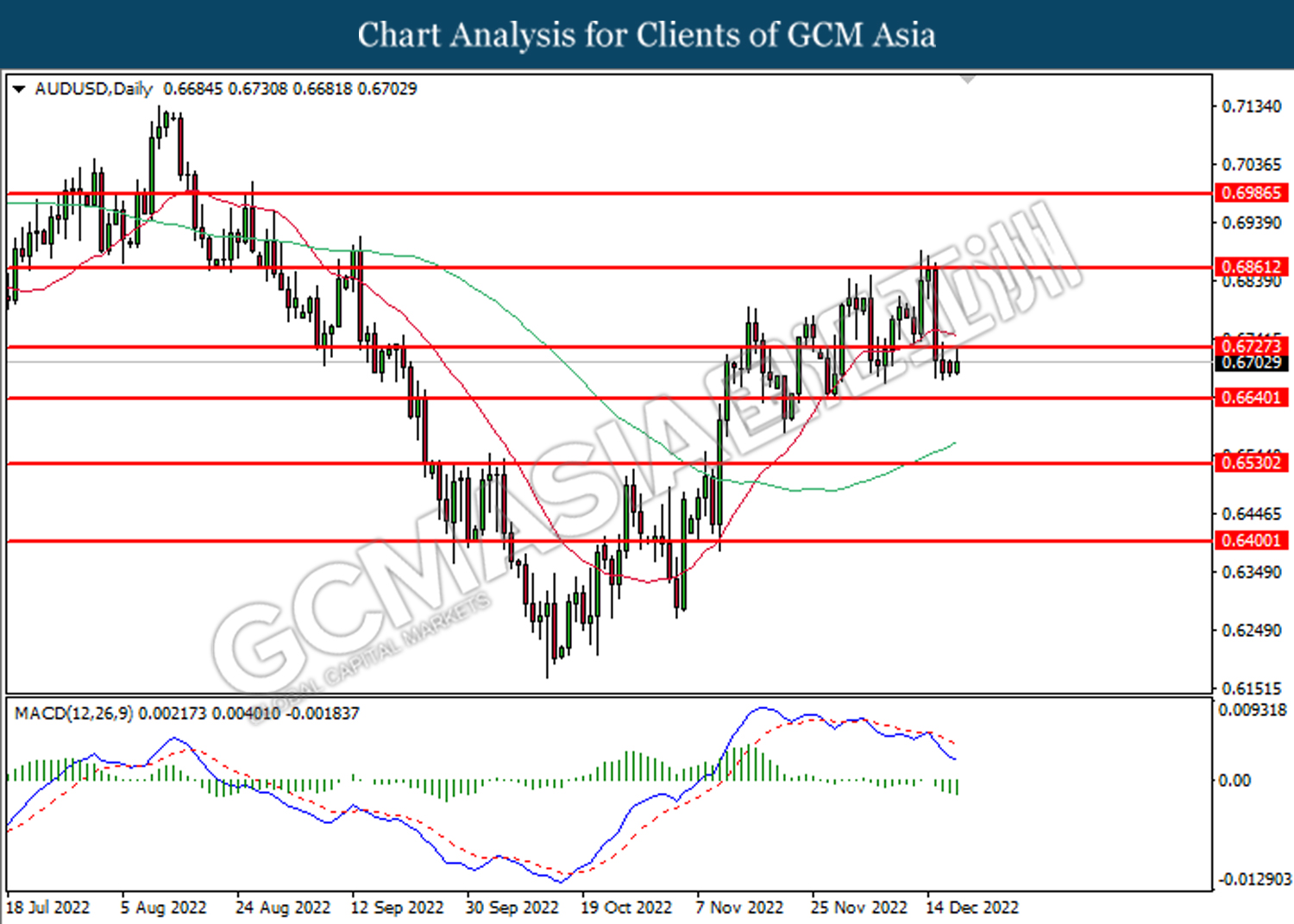

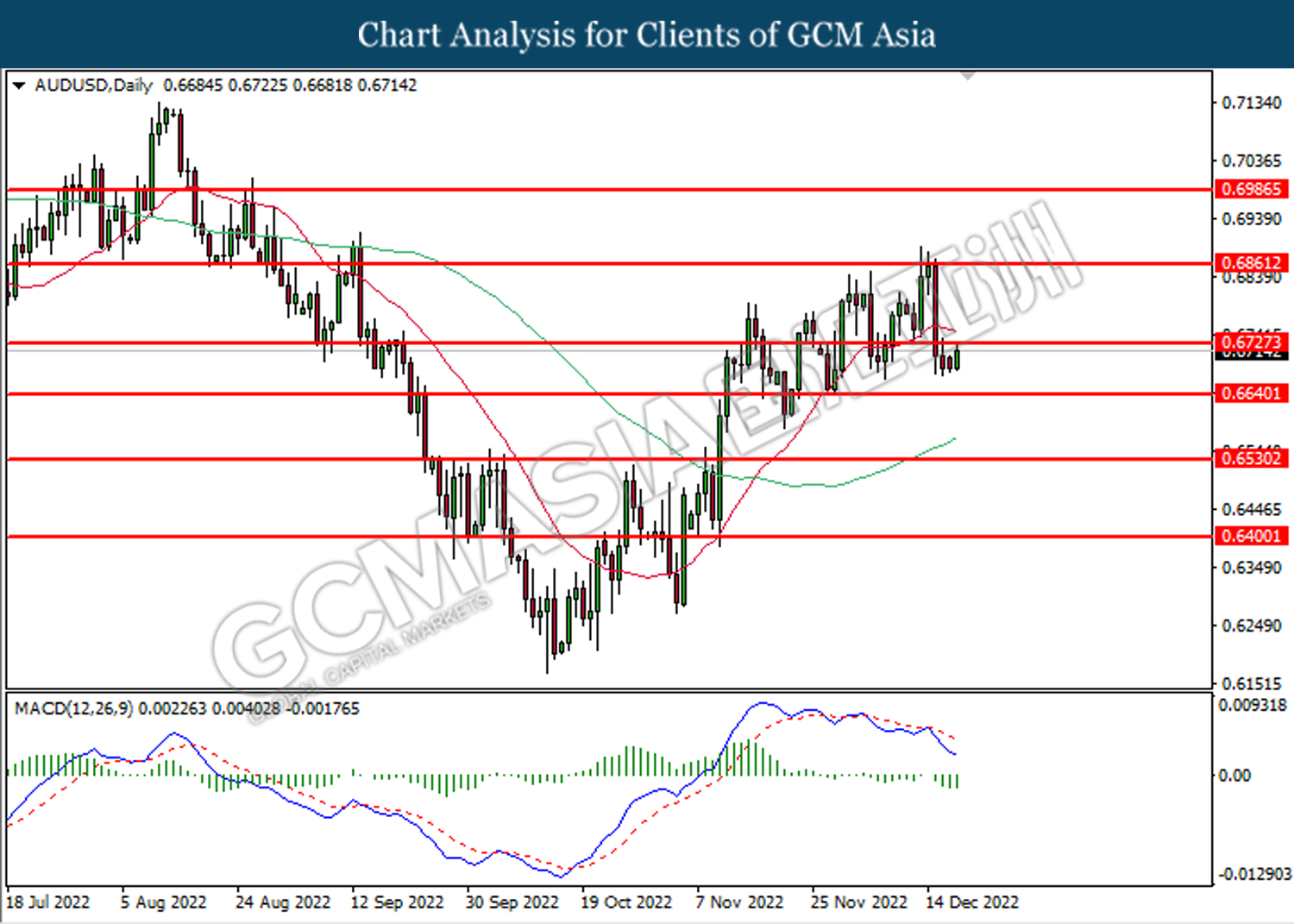

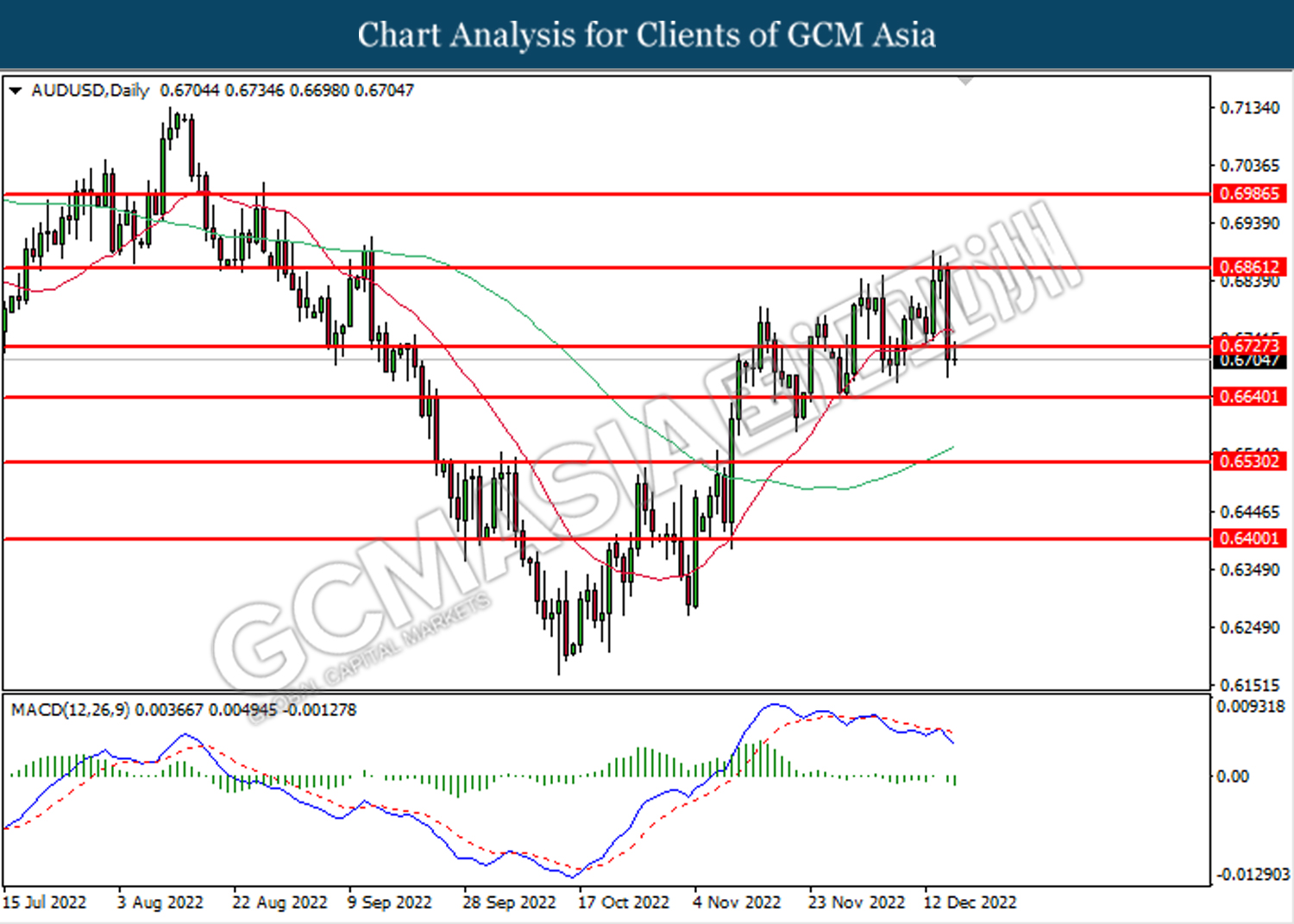

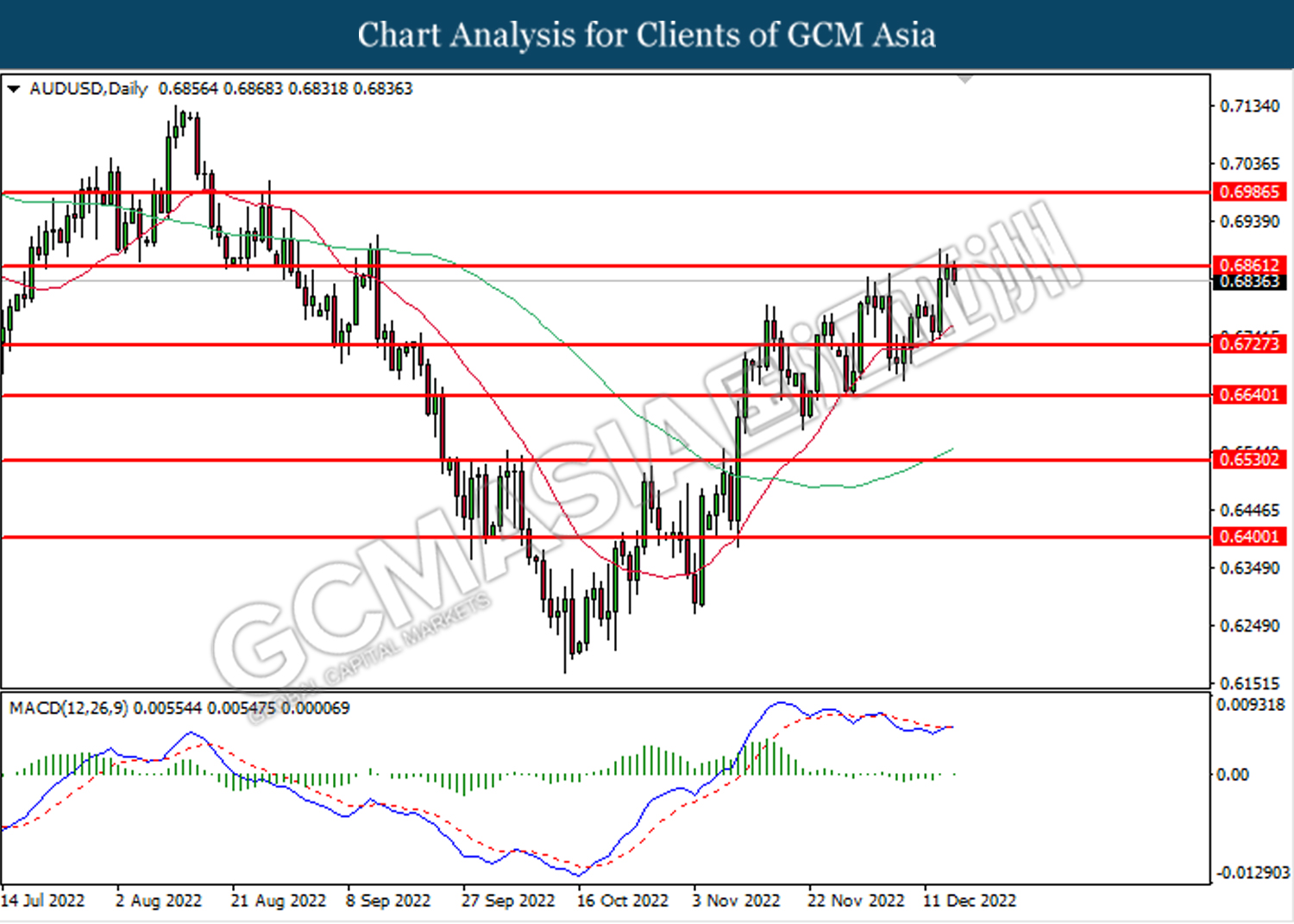

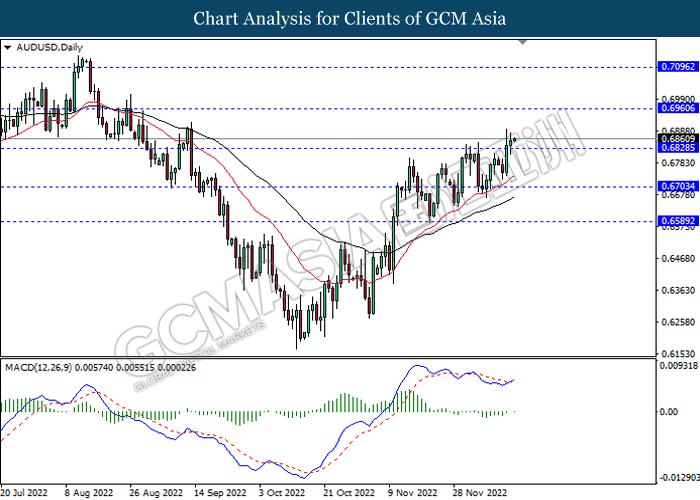

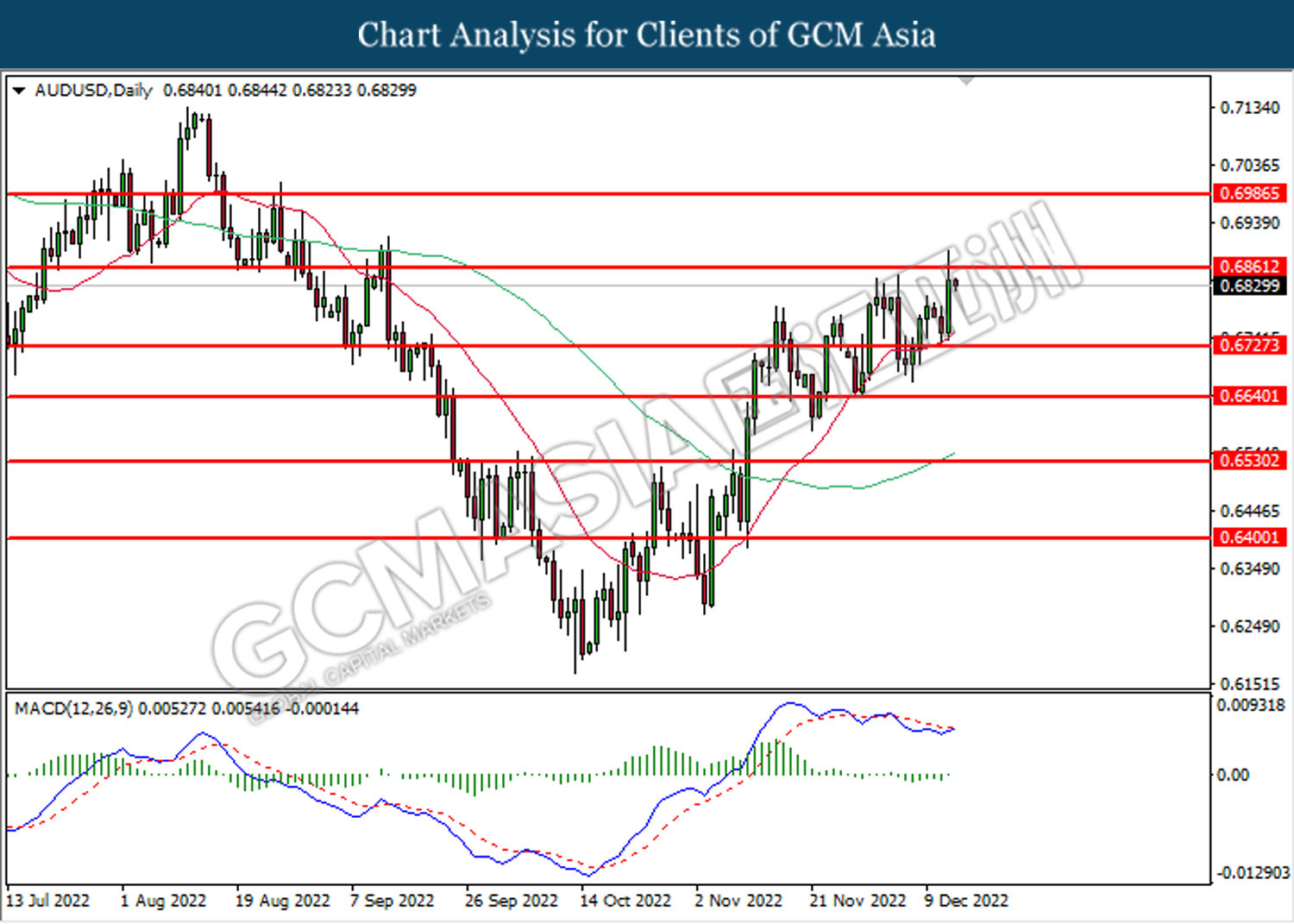

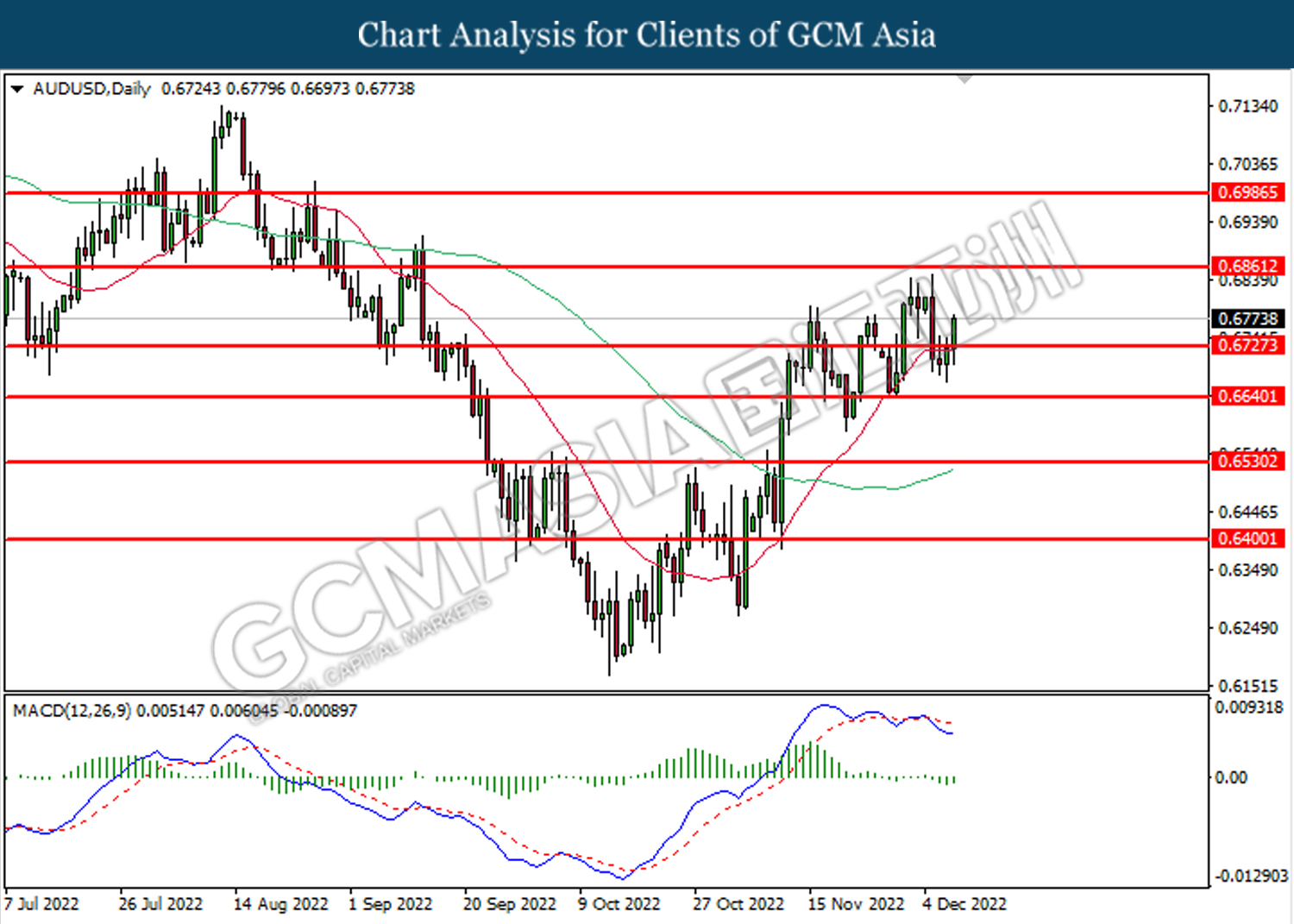

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

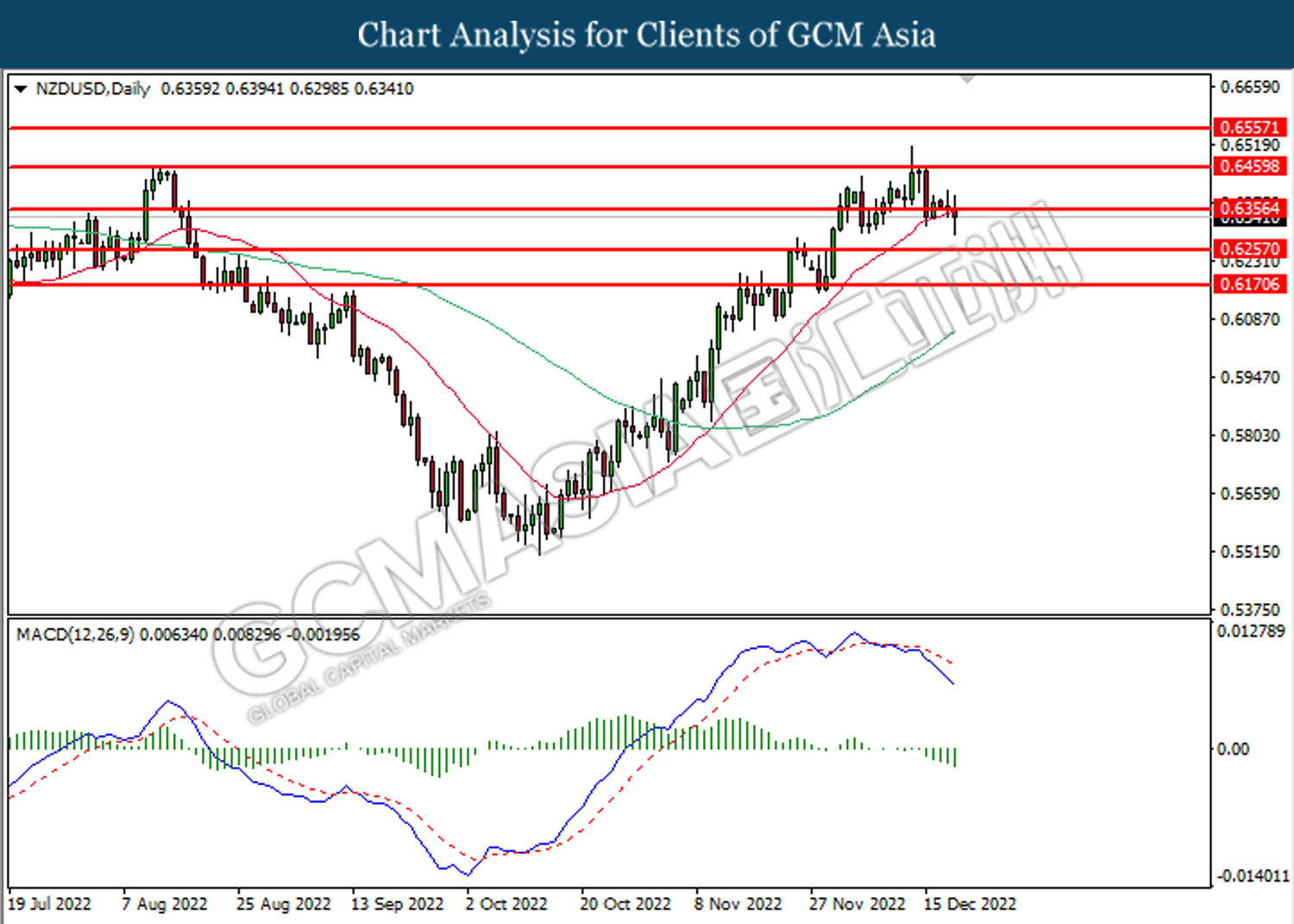

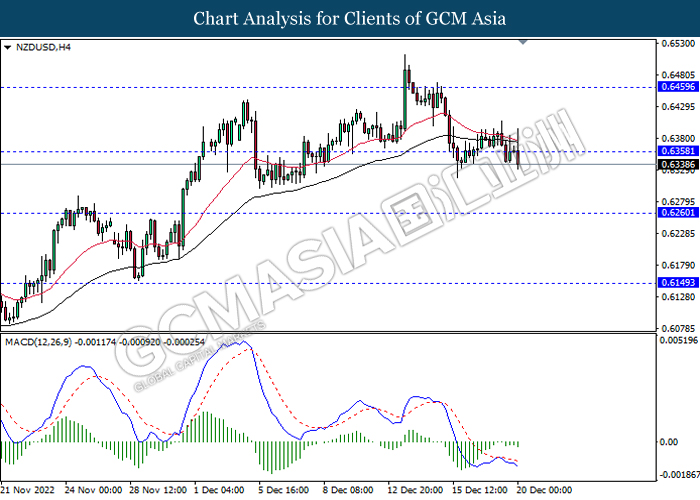

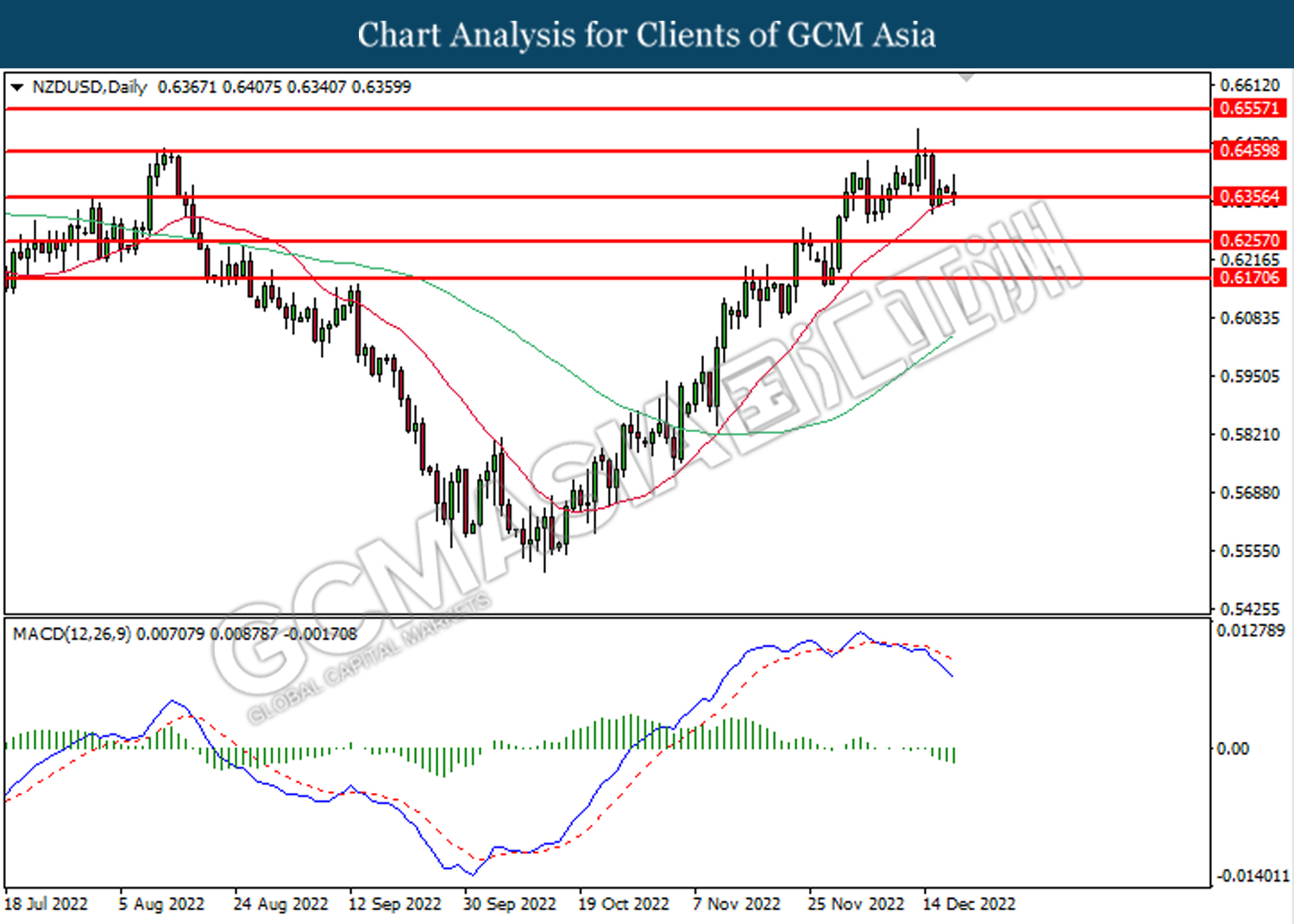

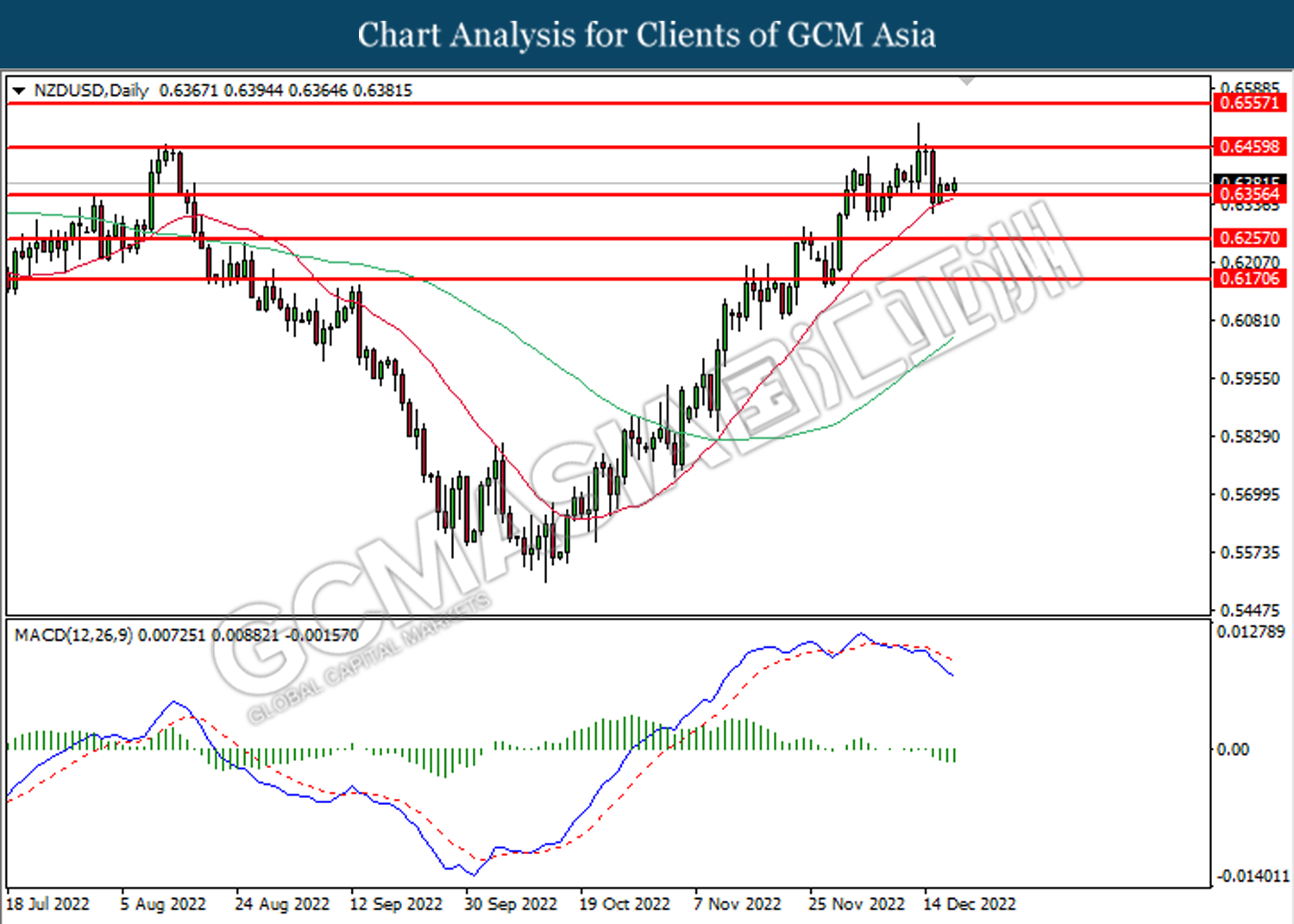

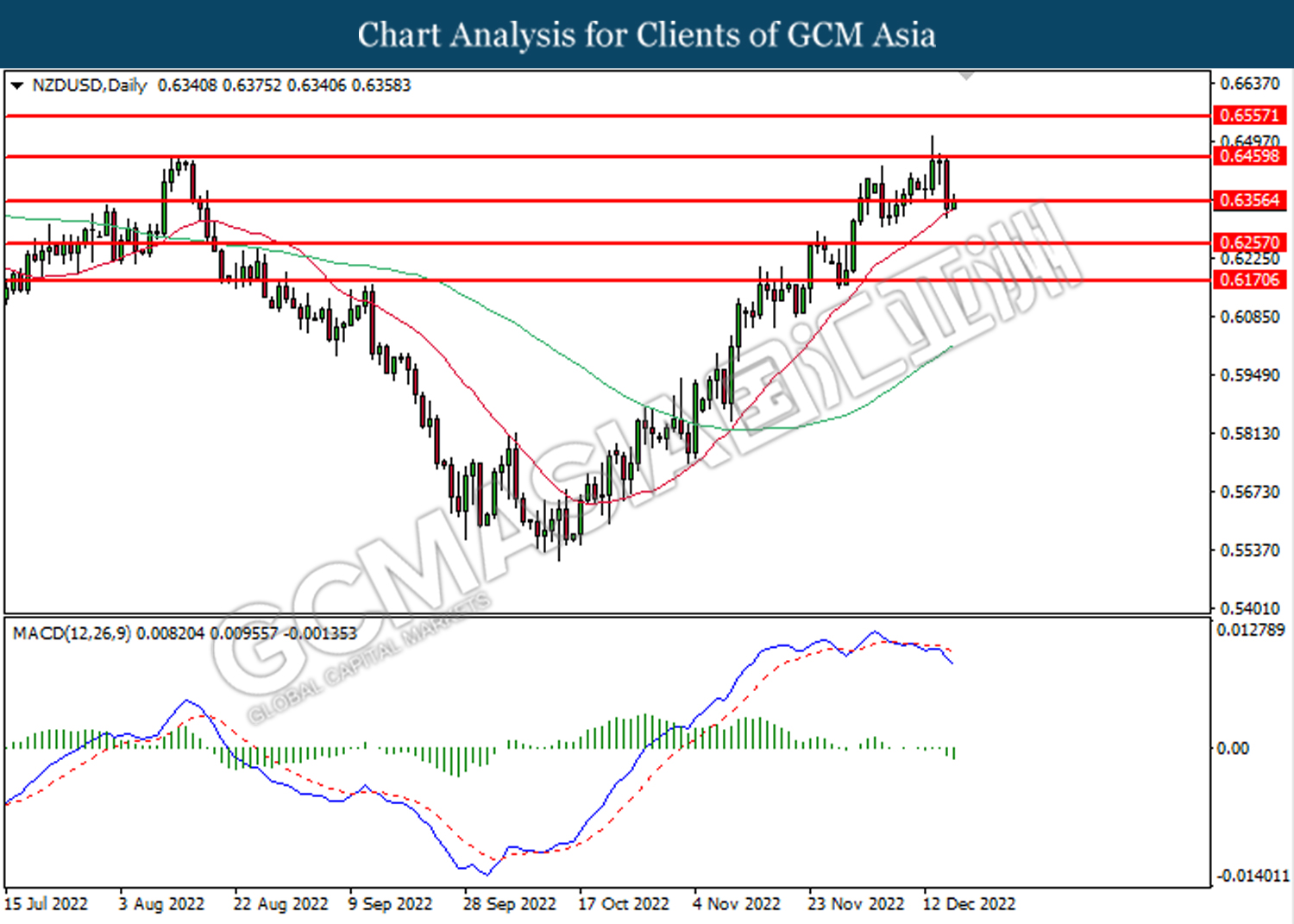

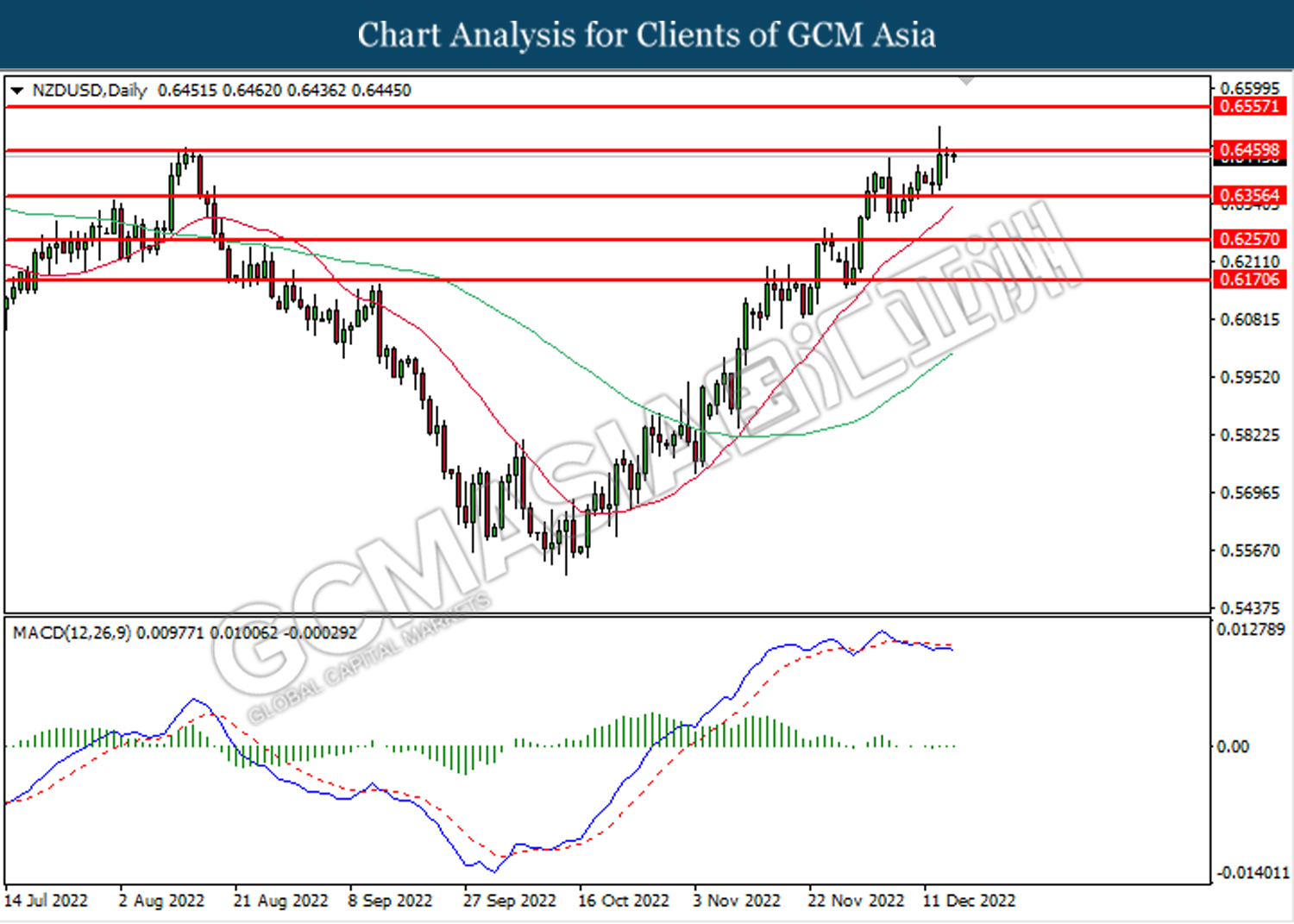

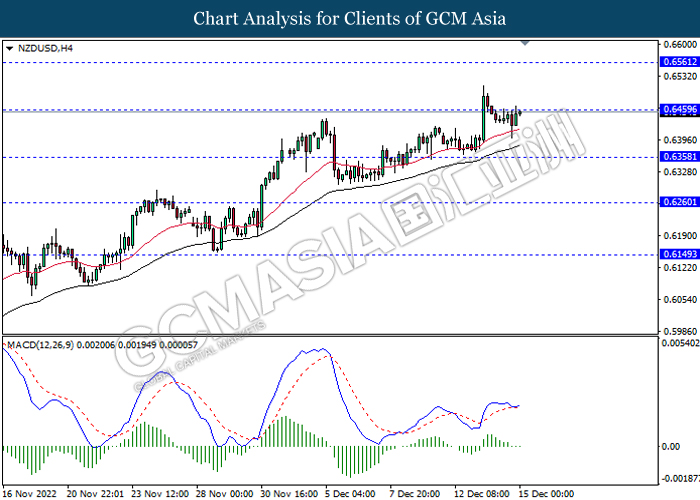

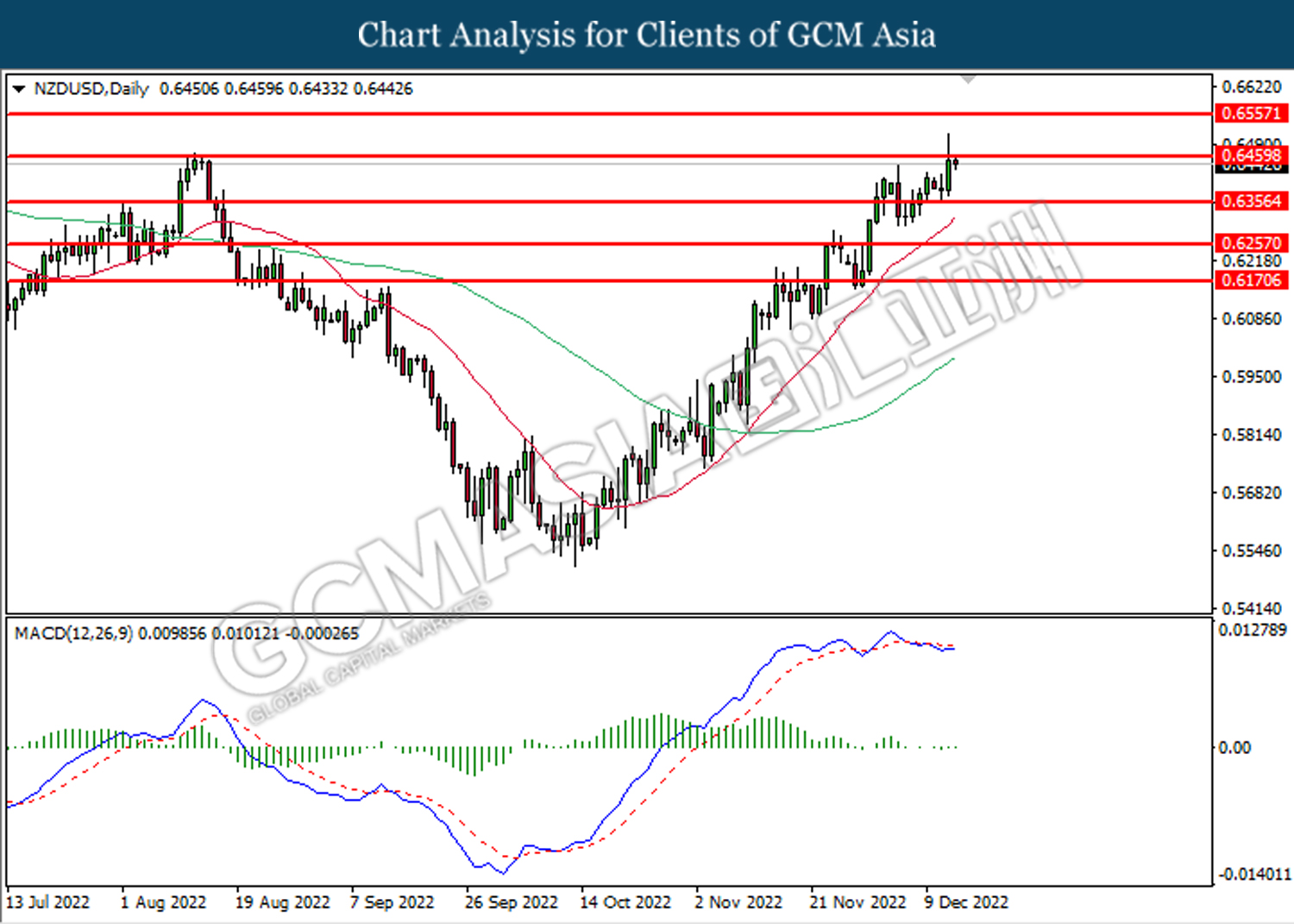

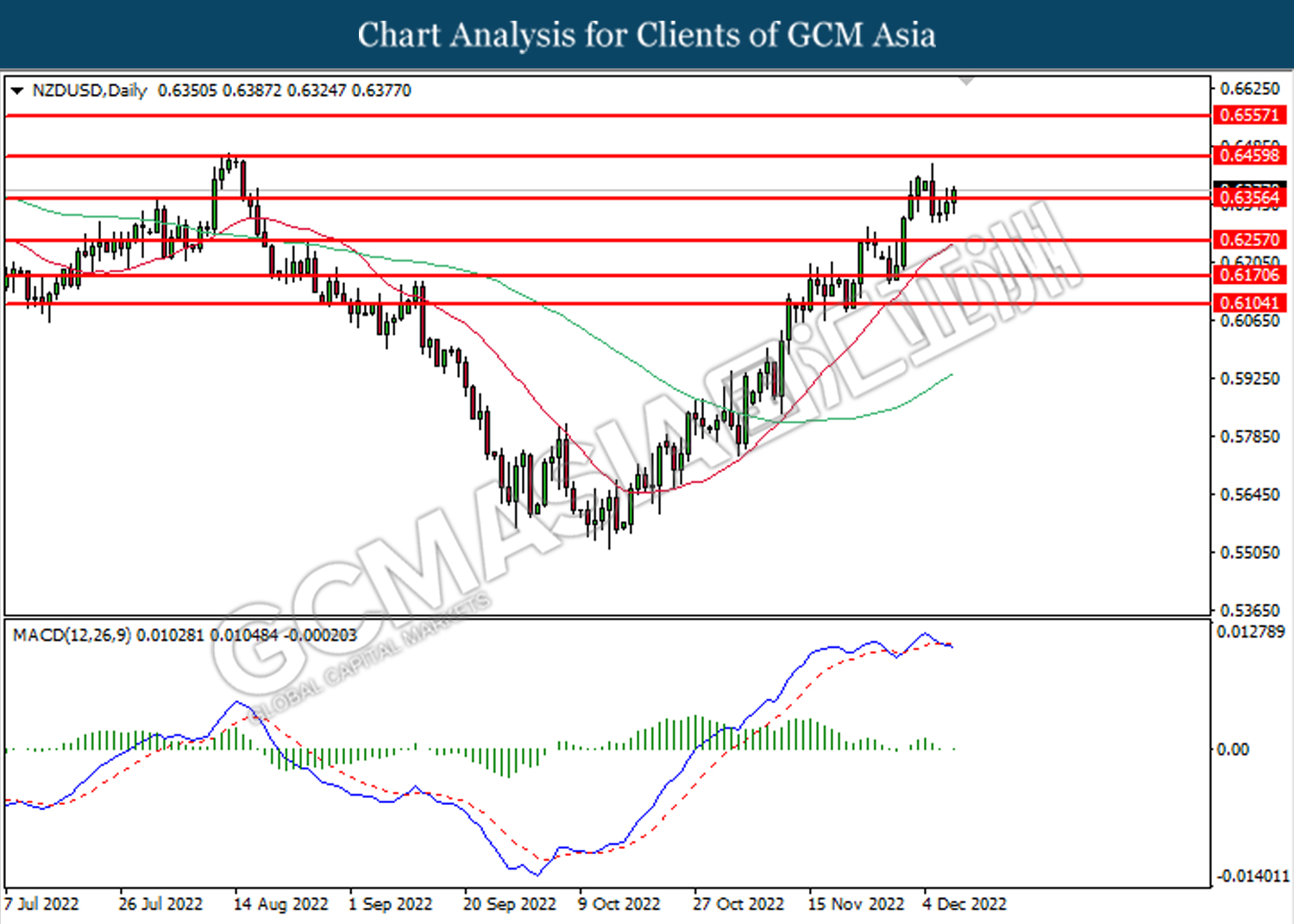

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

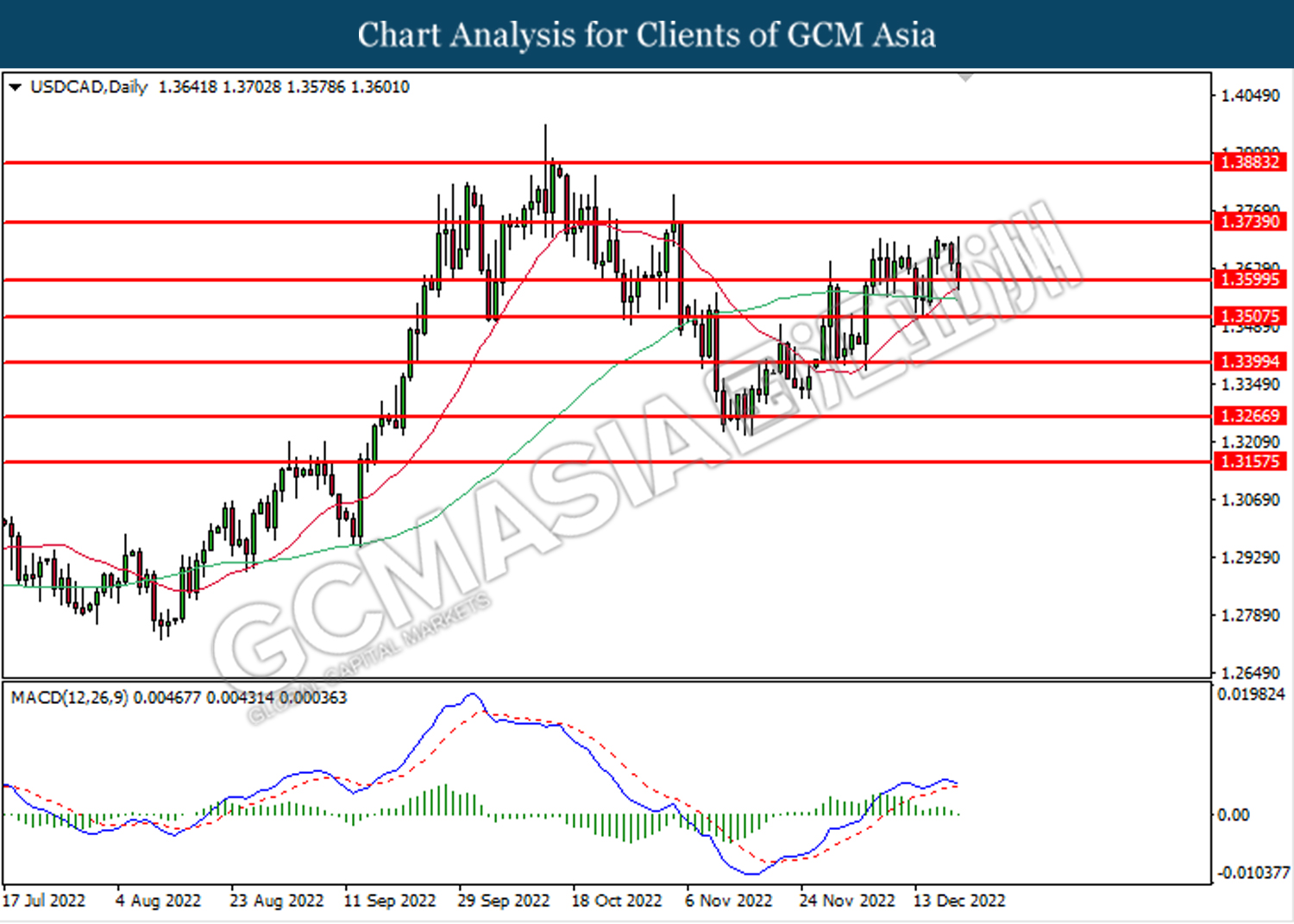

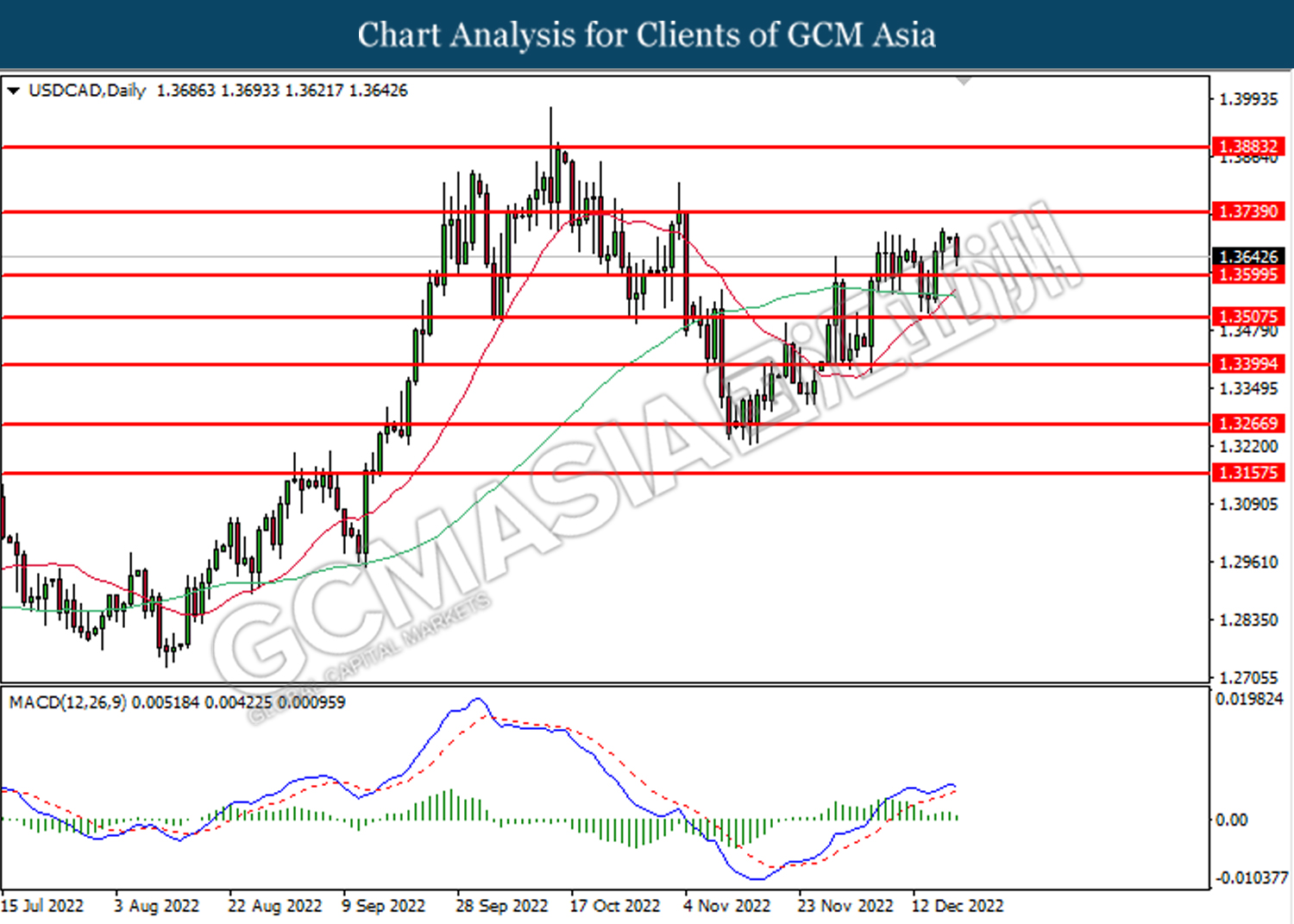

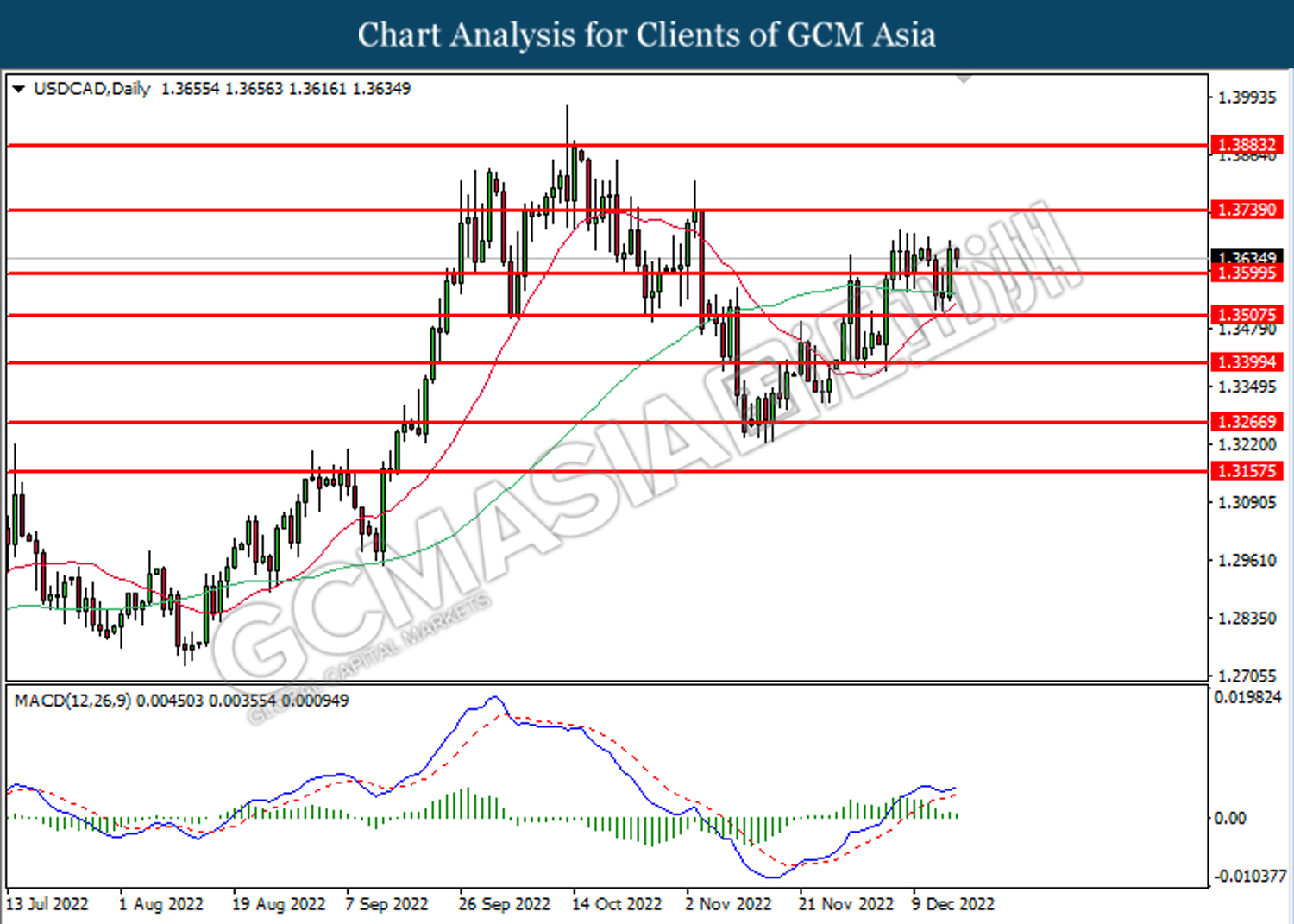

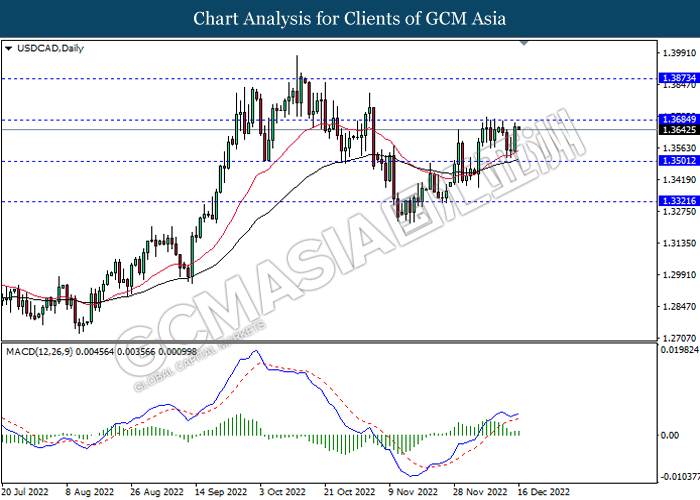

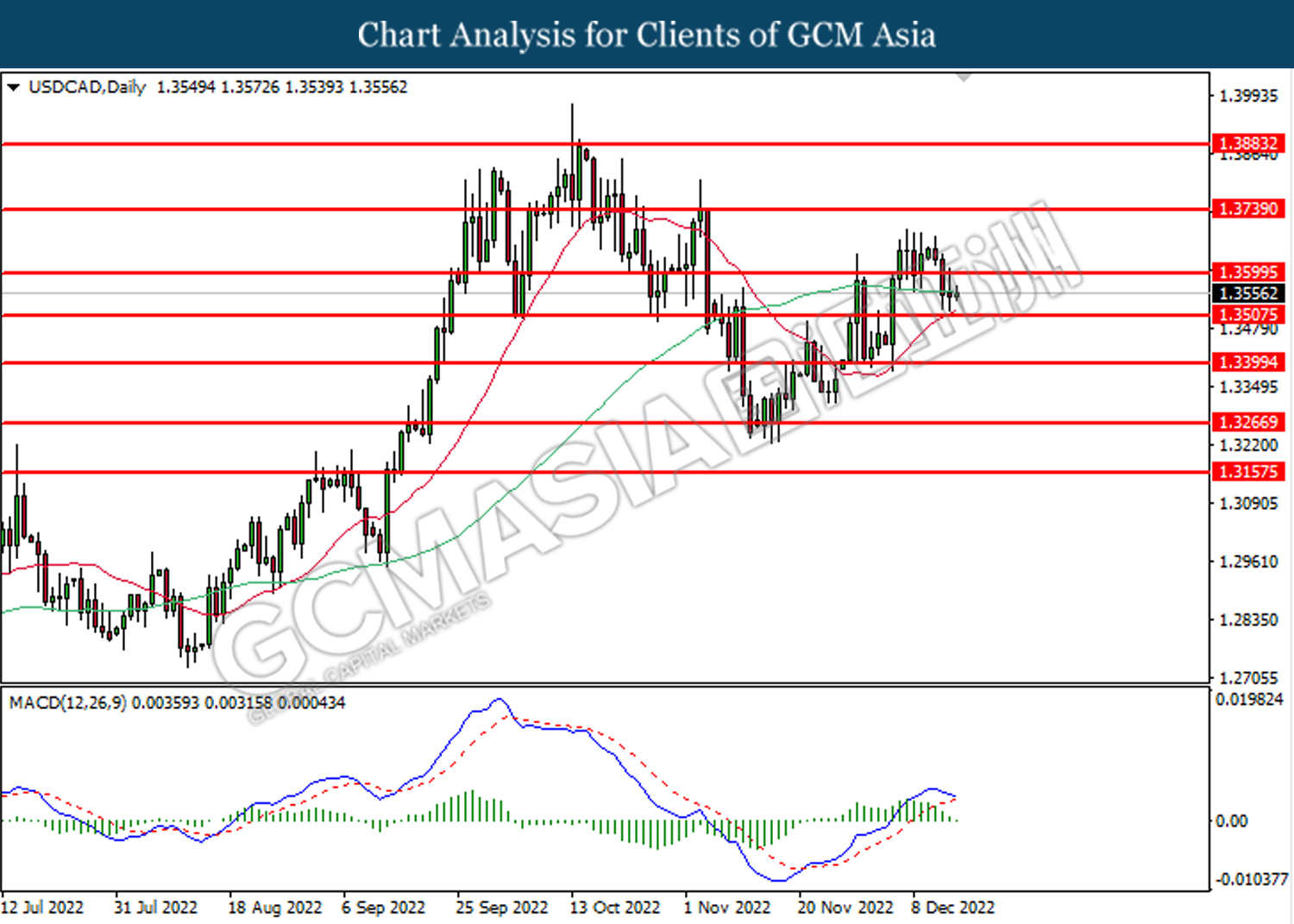

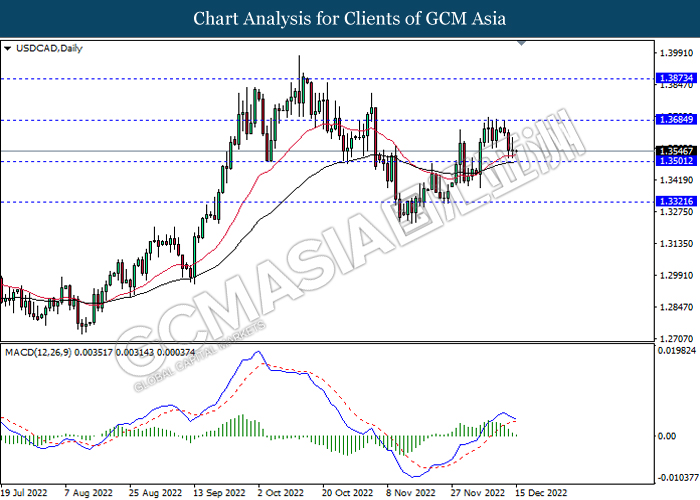

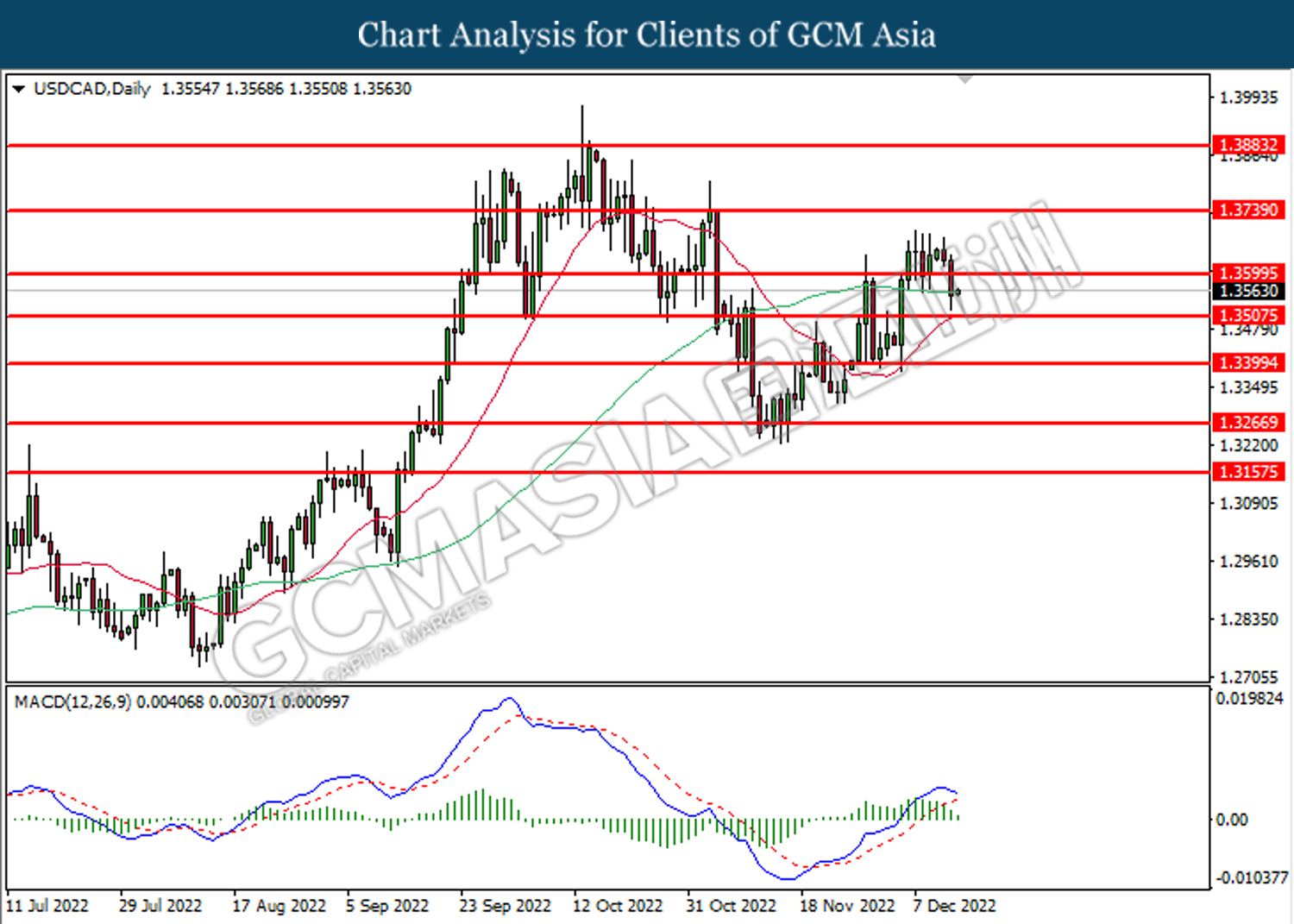

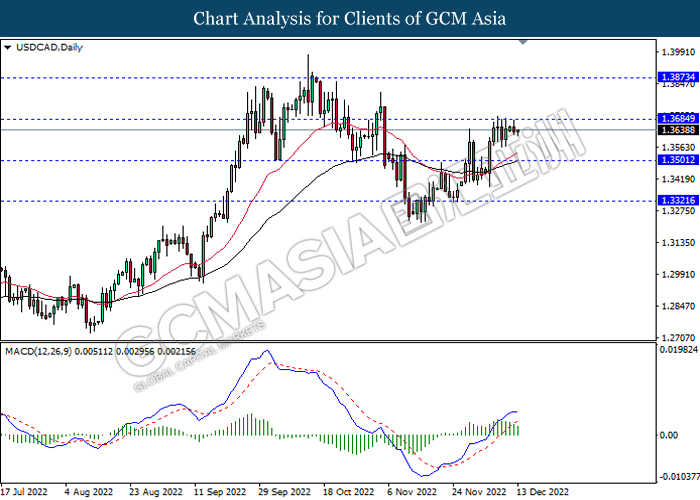

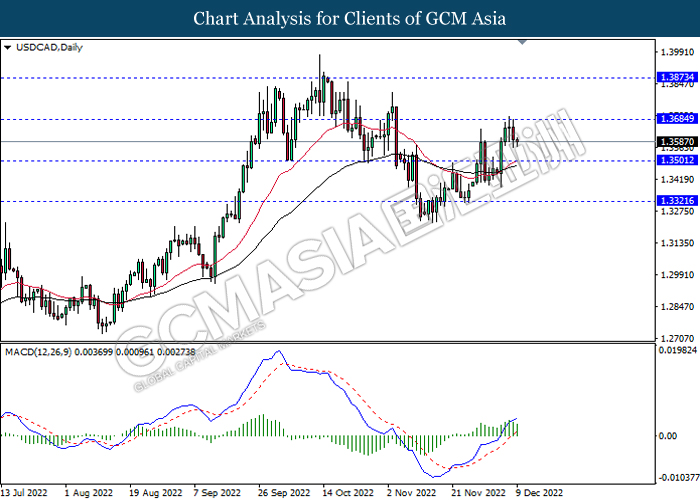

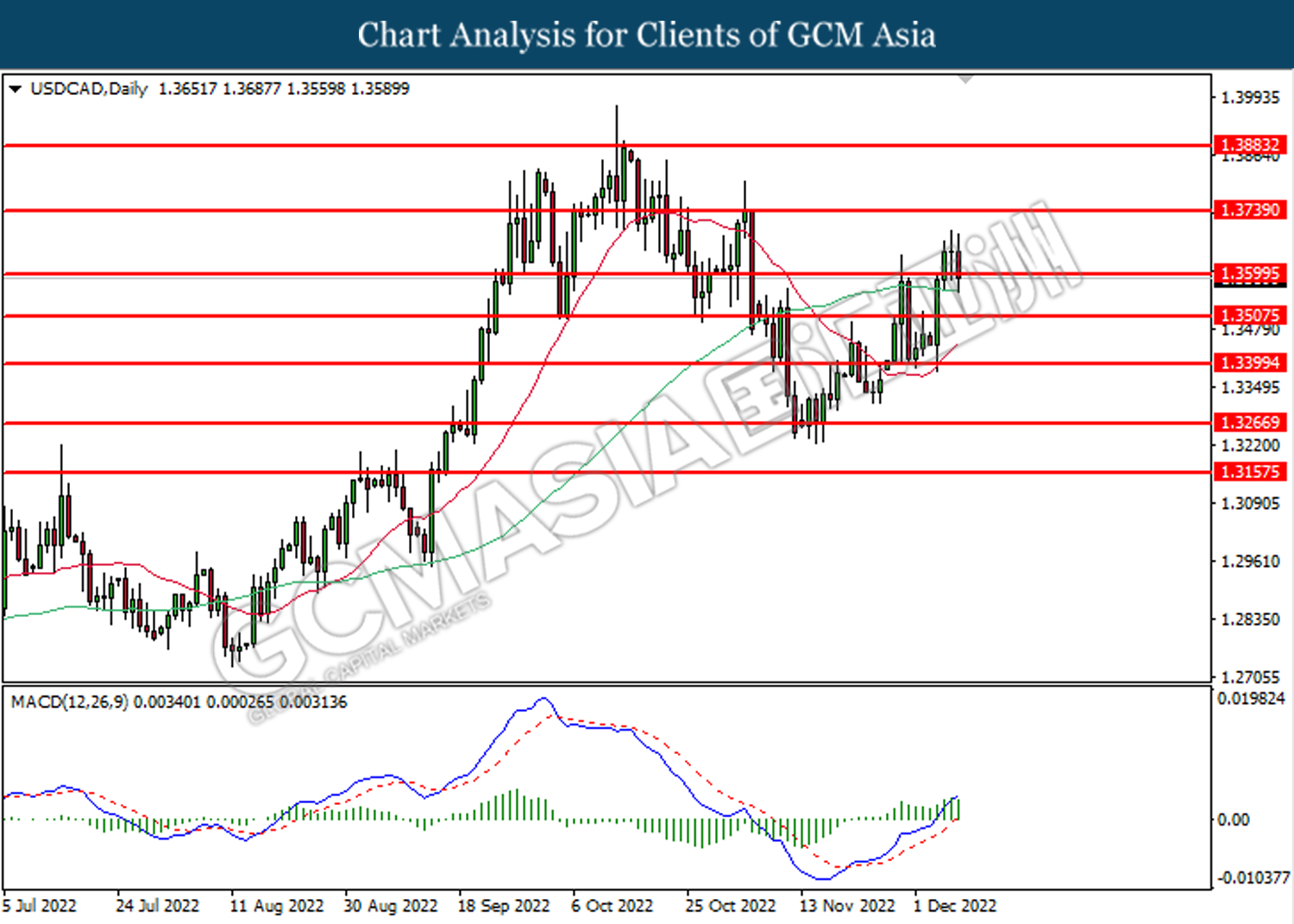

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

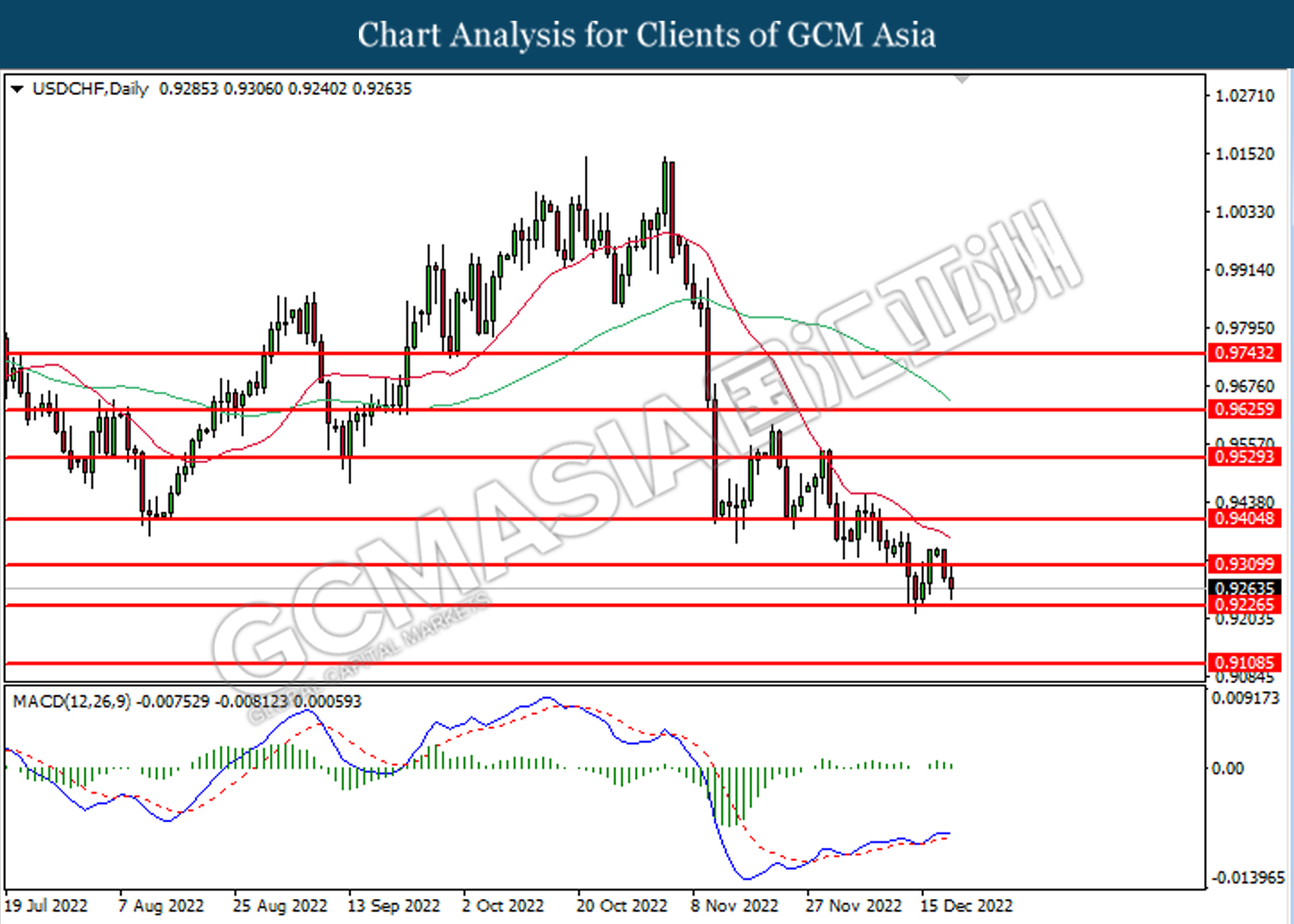

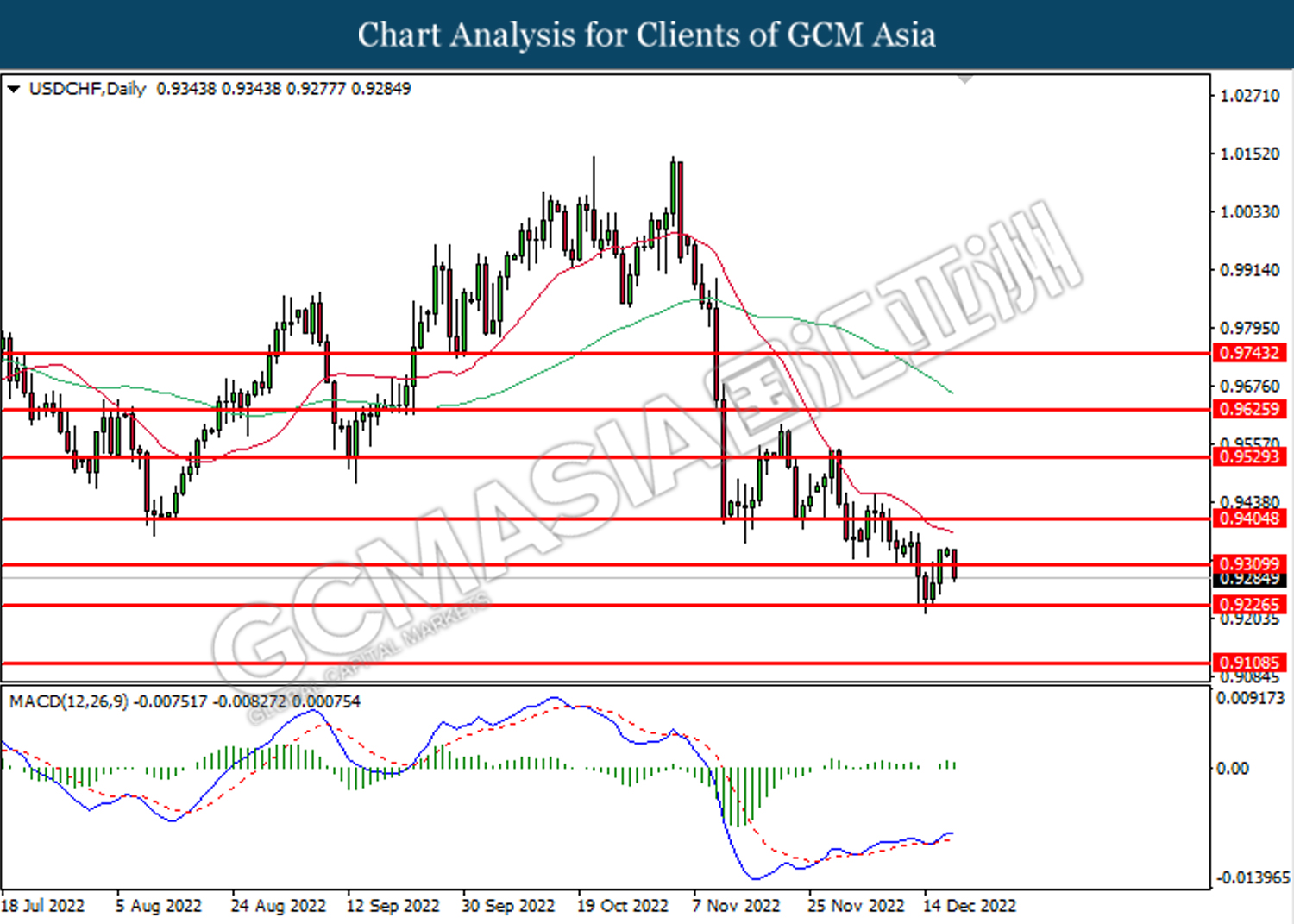

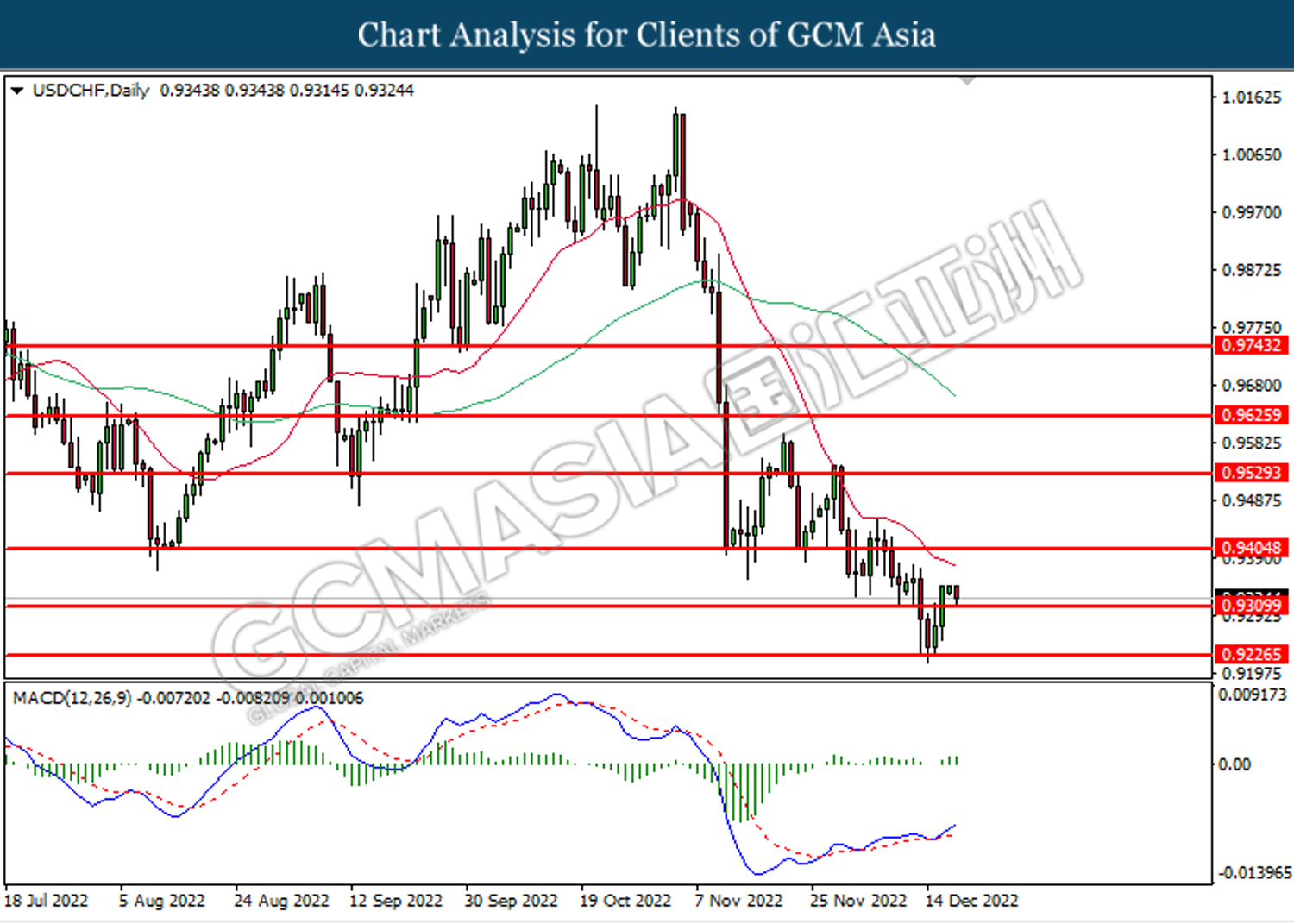

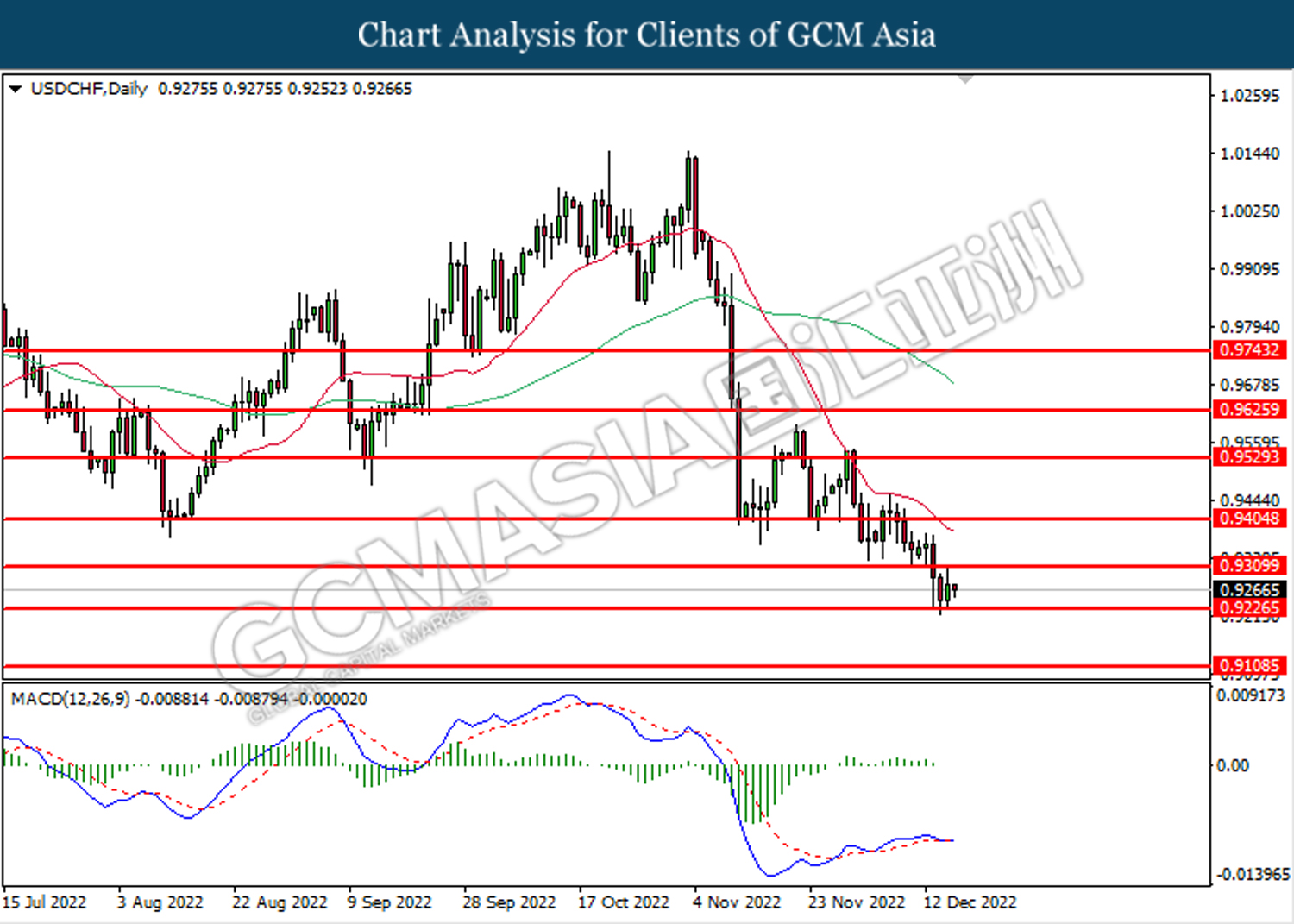

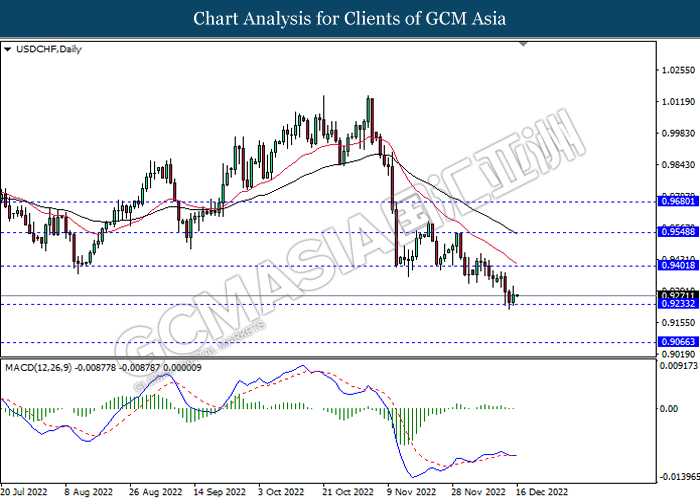

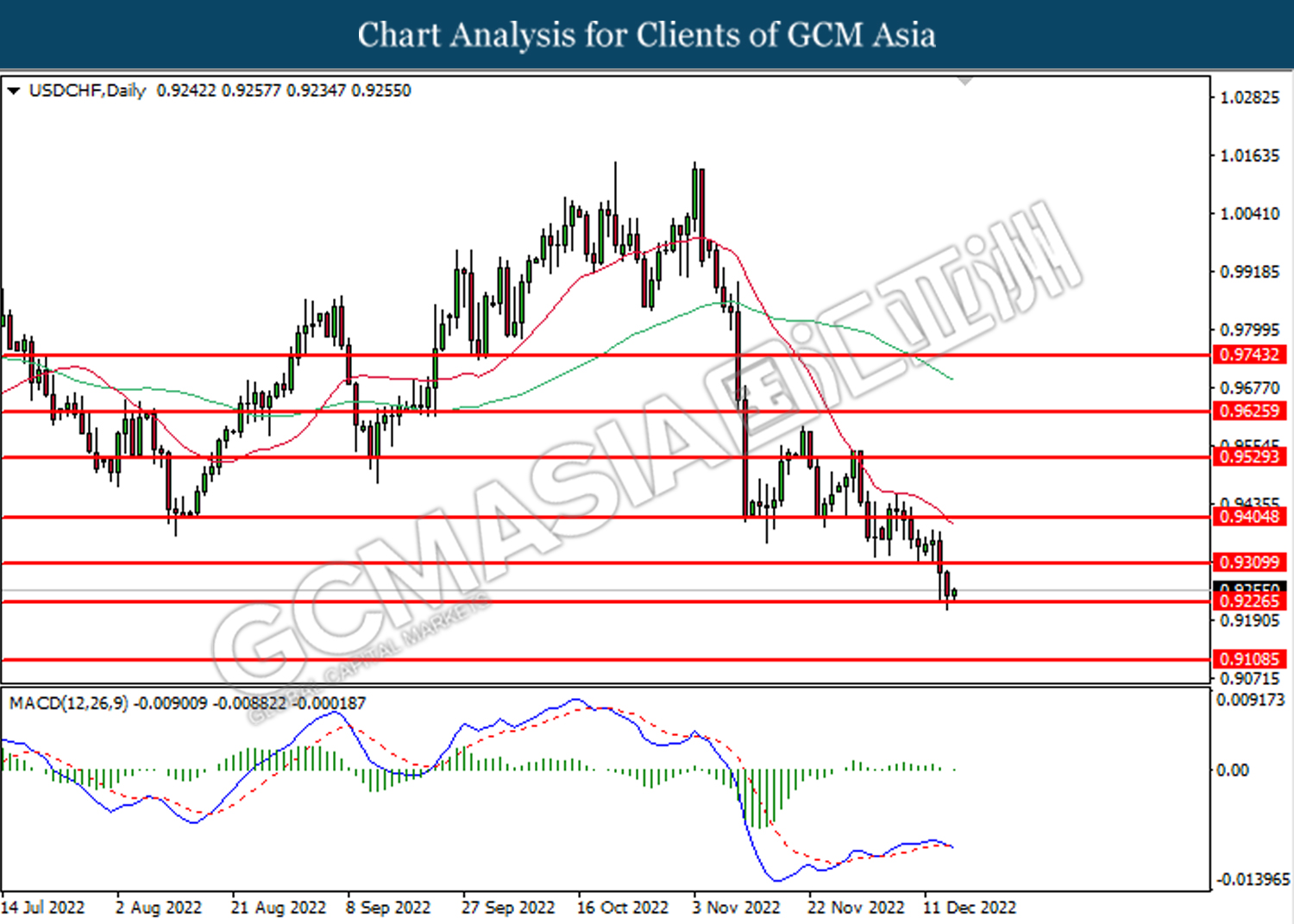

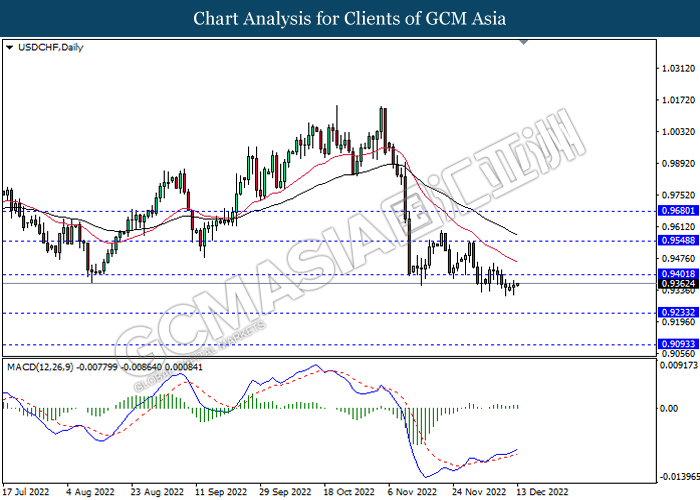

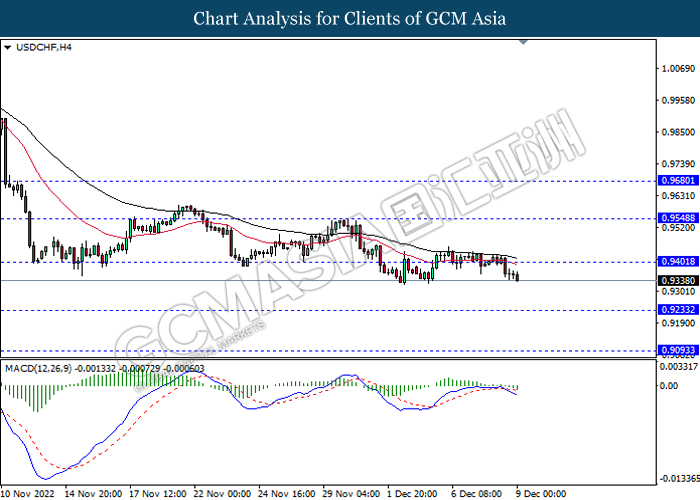

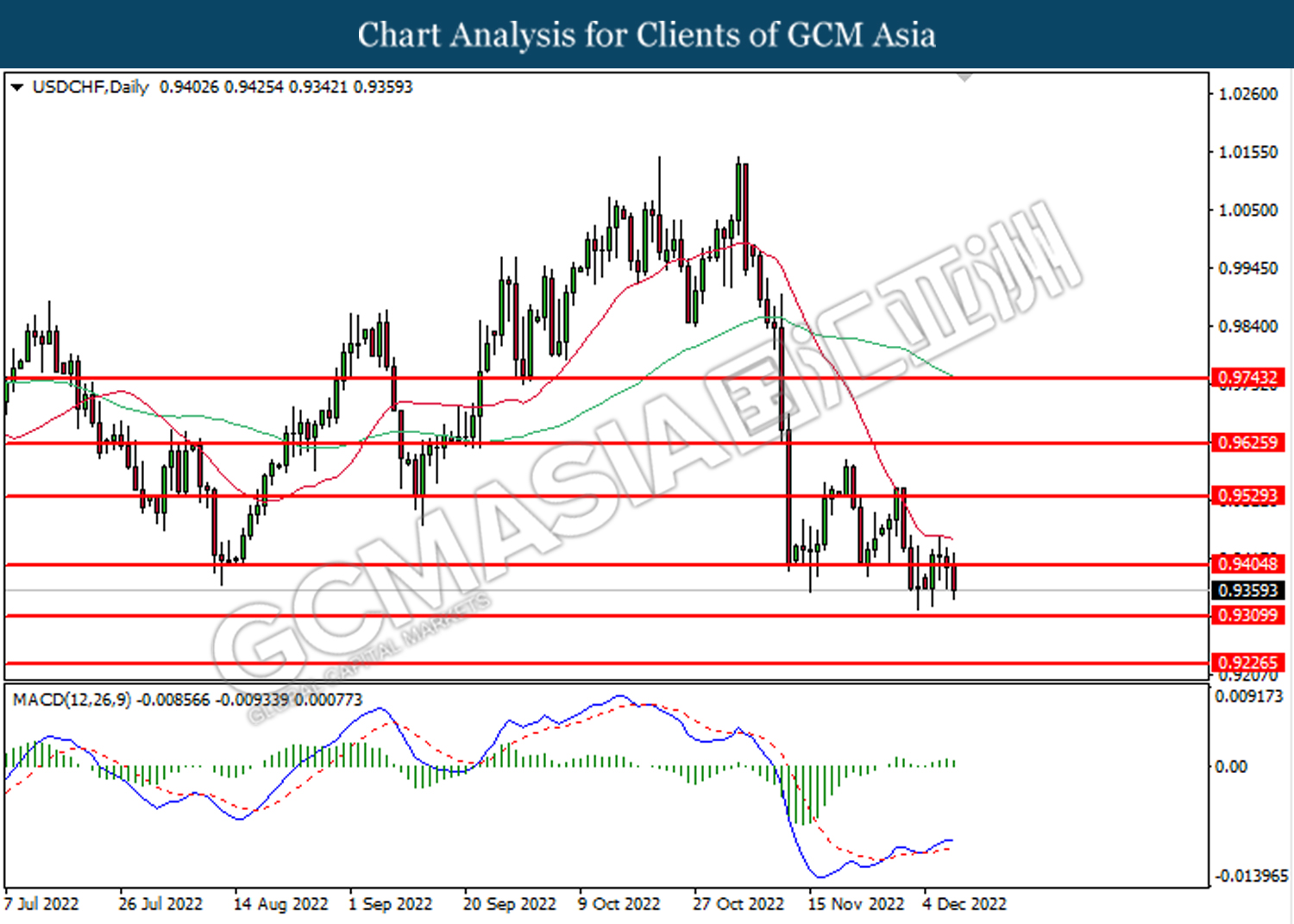

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

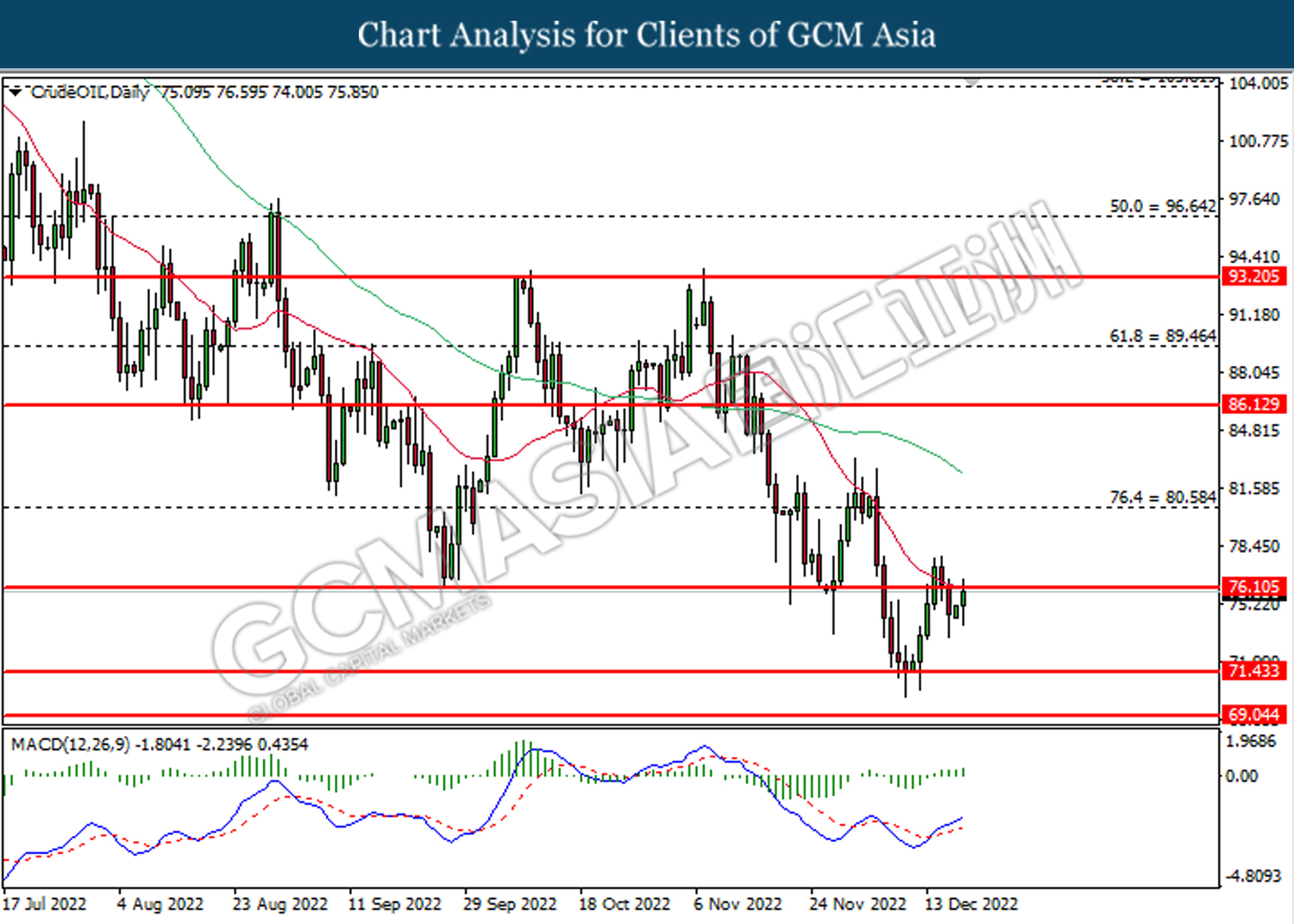

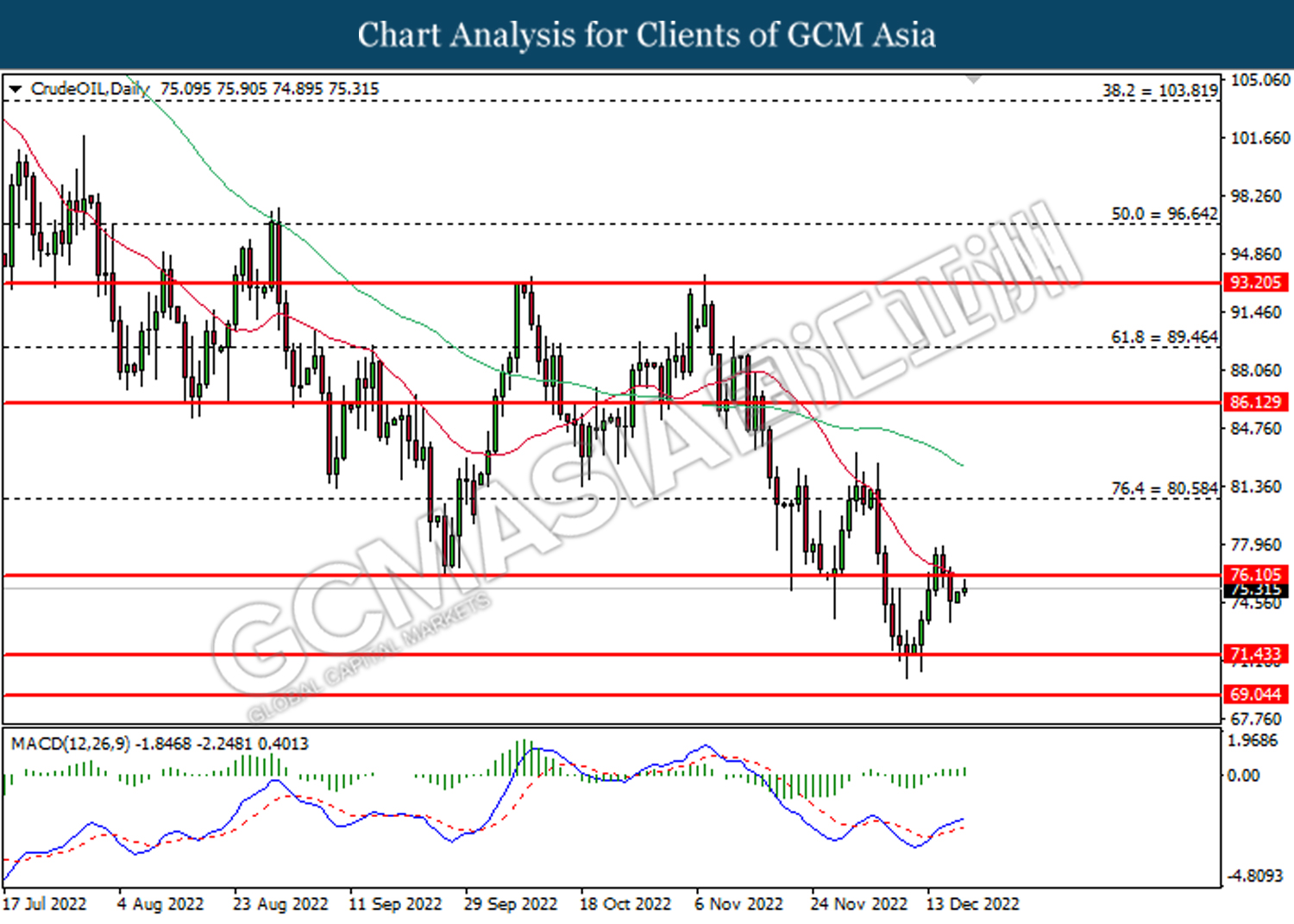

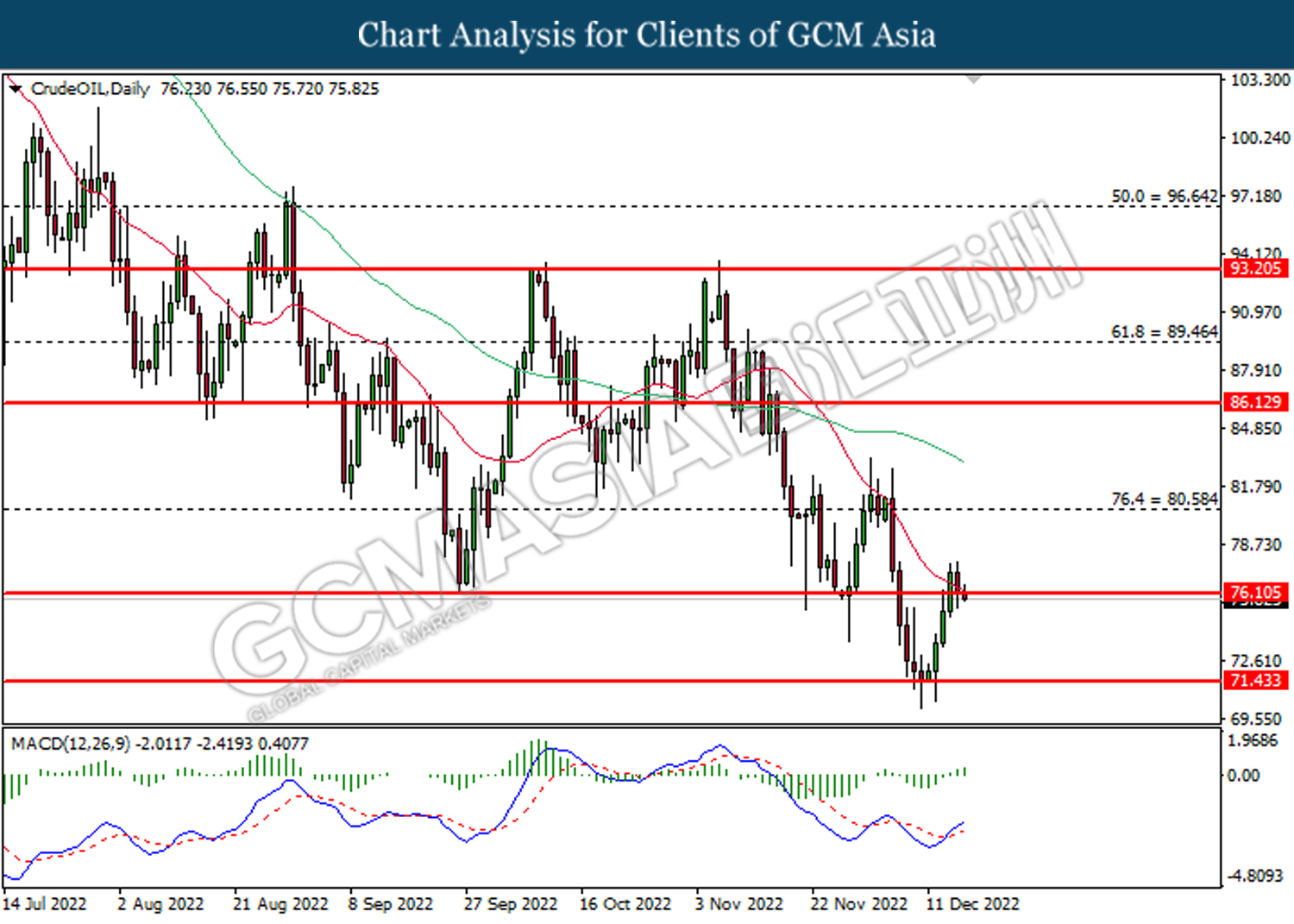

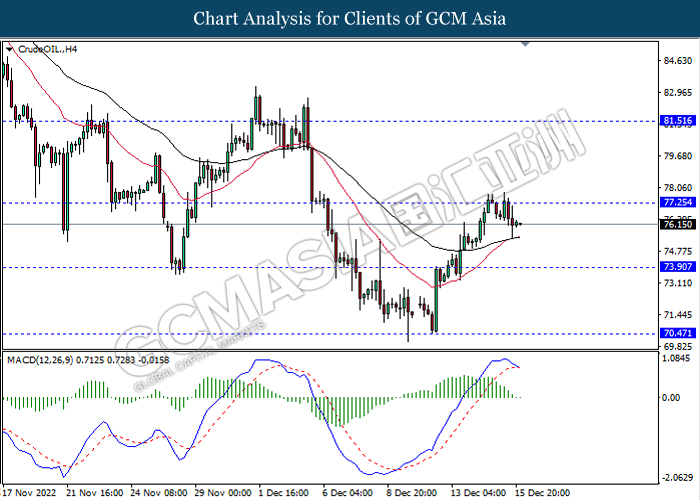

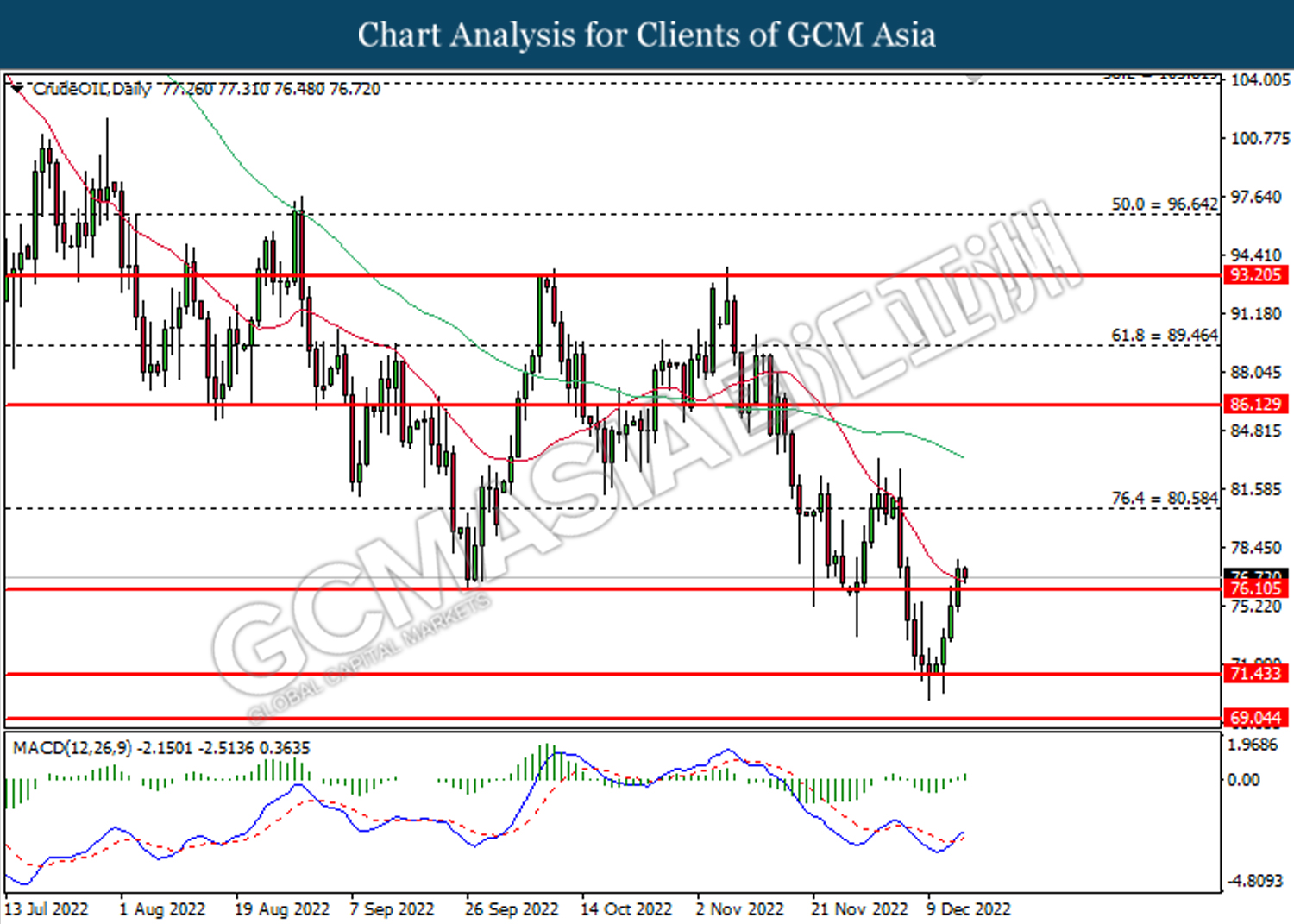

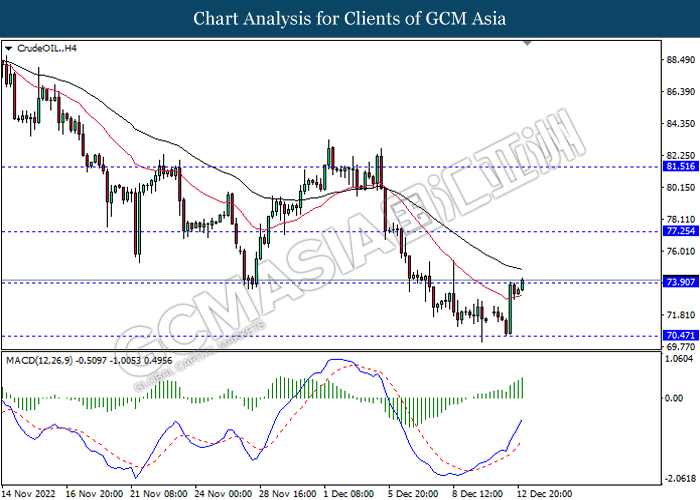

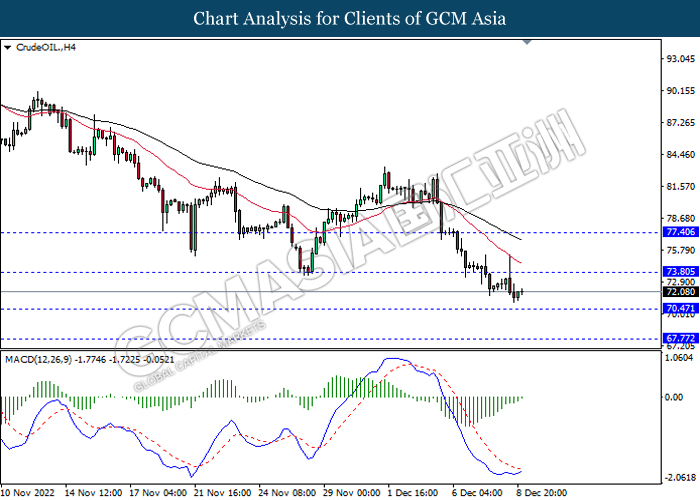

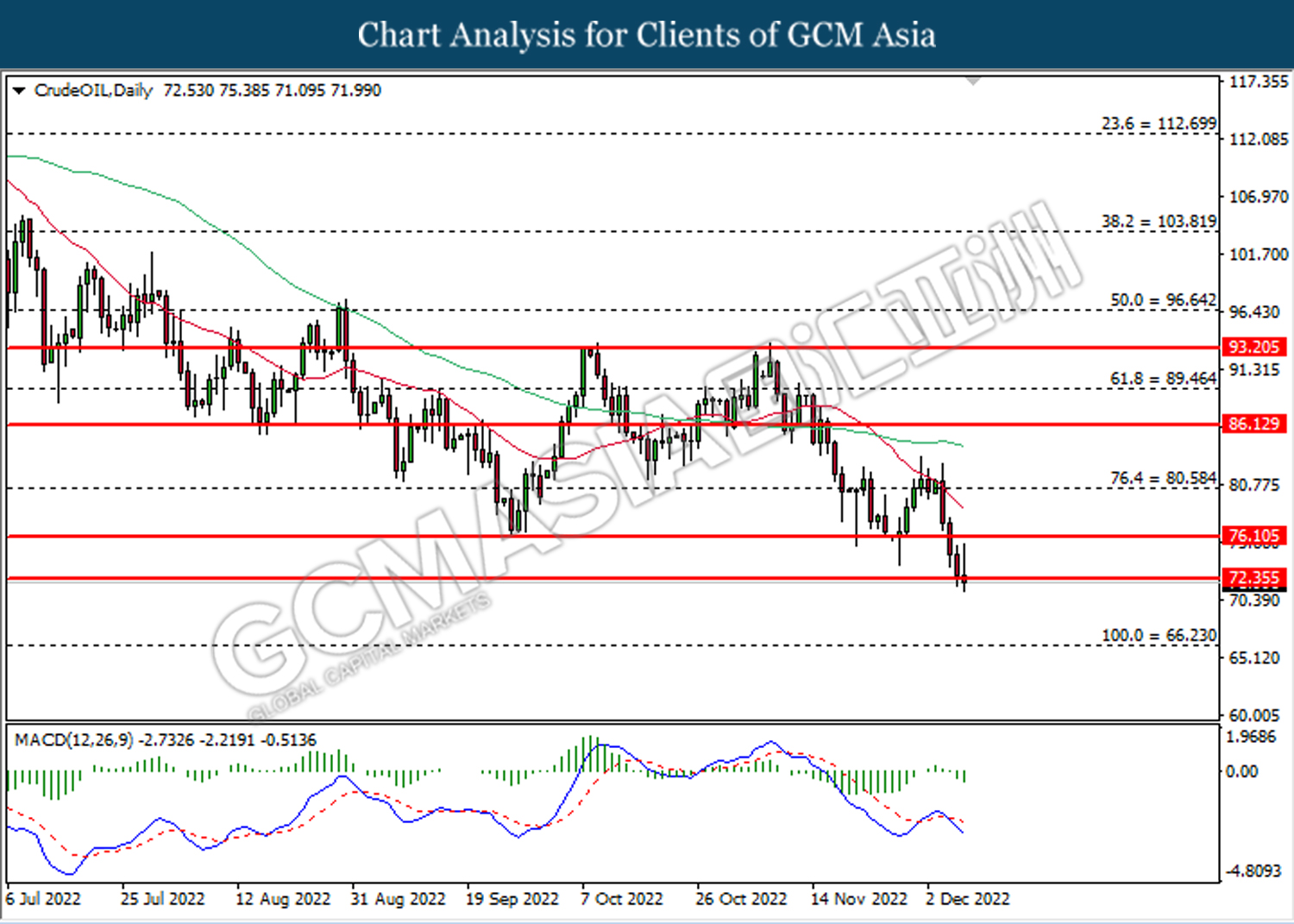

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

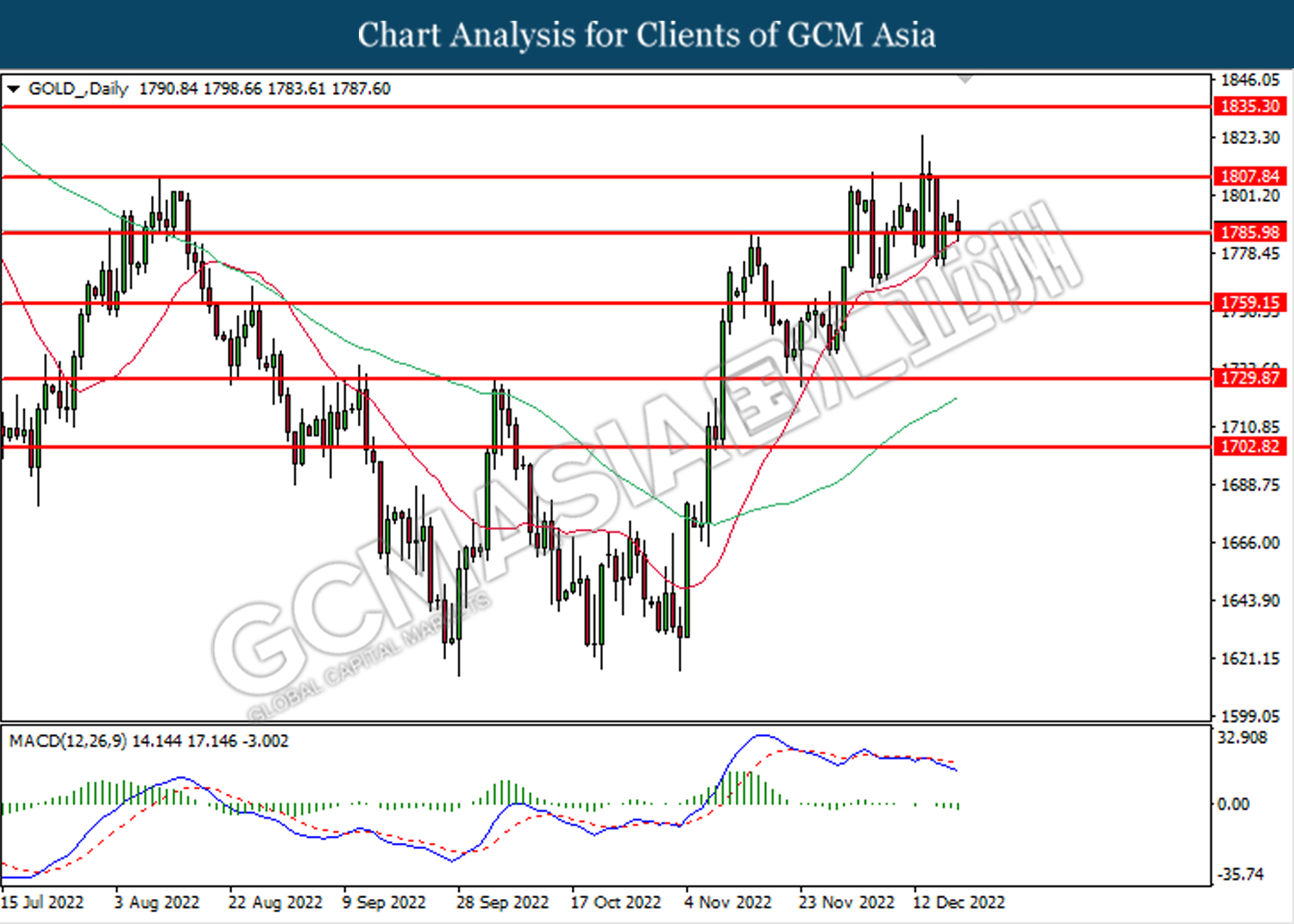

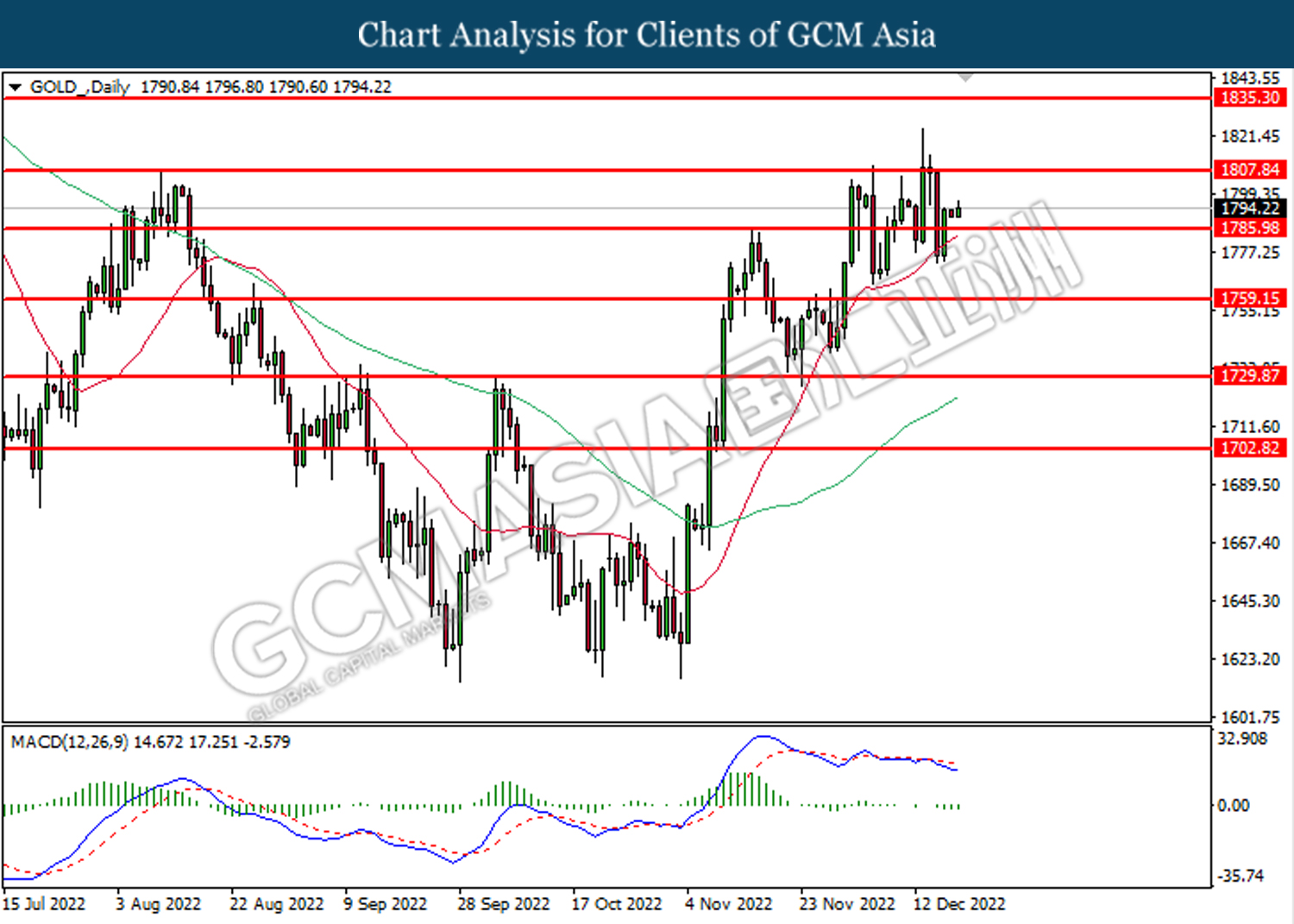

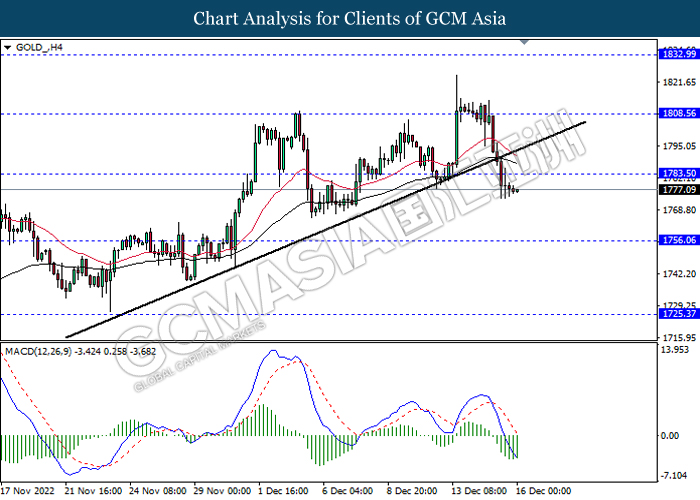

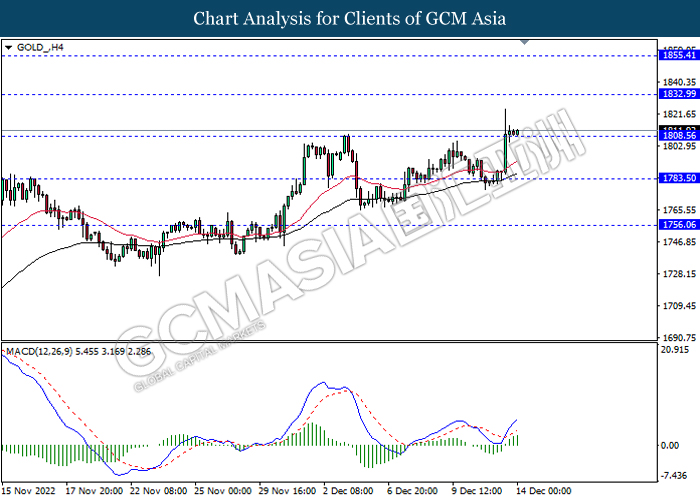

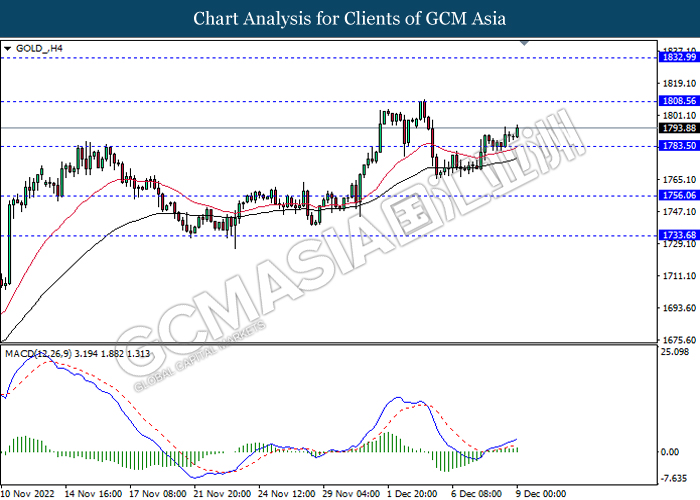

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1807.85 MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1807.85.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15

201222 Afternoon Session Analysis

20 December 2022 Afternoon Session Analysis

Euro plunged as economic condition might be threatened further.

The EUR/USD, which widely traded by global investors lost its ground on yesterday following the rising possibilities of energy crisis face by European. According to CNBC, European Union (EU) agreed to implement a price cap on natural gas. French Energy Minister Agnes Pannier Runacher claimed on yesterday that the range of 160 to 200 euros [eur/MWh] is acceptable for France nation. The move is intended to shield consumers from the spiking gas price that driven by invasion of Russia-Ukraine. European natural gas price reached historic levels of around 350 euros per megawatt hour in August, whereas market participants were concerned about the bloc’s unity in fighting the energy crisis. However, the profits of gas sellers would likely to be deducted when the price cap was implemented, as well as gas-producing countries may not sell their gas to the EU. With that, it would likely to exacerbate the energy crisis issue in the Eurozone, which dragged down the value of Euro. As of writing, the EUR/USD edged up by 0.03% to 1.0614.

In the commodities market, the crude oil price appreciated by 0.78% to $75.97 per barrel as of writing over the price cap implementation from EU. On the other hand, the gold price rose by 0.18% to $1792.17 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Nov) | 1.512M | 1.485M | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Oct) | -0.7% | 1.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 135.35, 139.00

Support level: 131.30, 126.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

201222 Morning Session Analysis

20 December 2022 Morning Session Analysis

Greenback dipped amid upbeat German economic data.

The dollar index, which traded against a basket of six major currencies, lingered near the level of 104.00 after slipping slightly amid yesterday upbeat German economic data. According to the ifo Institute for Economic Research, the Germany Ifo Business Climate Index jumped from prior month reading of 86.4 to 88.6, beating the consensus forecast at 87.4. The stronger-than-expected reading showed some improvement in German business morale, lifting up the appeal of the single currency. However, the dark clouds are still circling the economic environment of the union as the challenges of high inflation and falling of demand persist. The market has seen some buying support on US Dollar as the market risk-off sentiment hyped as the end of the year approached. In the meantime, the investors are also waiting for further economic data and events to scrutinize the market direction while adjusting the weight proportion of their portfolio. As of writing, the dollar index edged up 0.04% to 104.65.

In the commodities market, crude oil prices up by 1.67% to $75.85 per barrel on hopes that the economic recovery of China would boost up the energy demand despite the headwind of high recession risk. Besides, gold prices depreciated by -0.31% to $1787.80 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

11:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 21:30 | USD – Building Permits (Nov) | 1.512M | 1.485M | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Oct) | -0.7% | 1.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0615. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3600.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1786.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its gains after it successfully breakout below the support level at 1786.00.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15

191222 Afternoon Session Analysis

19 December 2022 Afternoon Session Analysis

Pound lingered following the release of mixed economic data.

The Pound Sterling, which was majorly traded by the global investors, hovered near the recent lows after UK released a series of mixed economic data. According to the Office for National Statistics, the UK Retail Sales data came in at -0.4%, missing the consensus forecast at 0.3%, while recording a significant drop from the prior month reading at 0.9%. It reflected that the consumer spending in the nation dropped sharply, which could be mainly attributed to the rate-hike plan from the Bank of England (BoE). Besides, the UK Manufacturing PMI dropped from 46.5 to 44.7, weaker than the consensus forecast at 46.5, while the UK Services PMI achieved the level of 50.0. Nonetheless, the gains of Pound were not seen as the recent hawkish statement from the Federal Reserve Chairman Jerome Powell continued to spark bearish momentum on the pairing of GBP/USD. As of writing, the pair of GBP/USD rebounded 0.40% to 1.2190.

In the commodities market, the crude oil price rose by 1.11% to $75.55 per barrel after the US president Joe Biden decided to refill the Strategic Petroleum Reserve (SPR) in February 2023. Besides, the gold prices rose 0.09% to $1794.90 per troy ounce amid dollar weakened during Asian trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Dec) | 86.3 | 87.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2130. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2130, 1.2000

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0585. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0675, 1.0775

Support level: 1.0580, 1.0475

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 136.45. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward resistance level at 0.9405.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1786.00. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15

191222 Morning Session Analysis

19 December 2022 Morning Session Analysis

US Dollar’s bull continued upon hawkish stance from Fed member.

The Dollar Index which traded against a basket of six major currencies extended its gains on Friday following the rising hopes upon the hawkish Fed speech. Last week, Federal Reserve decided to hike its interest rate by 50 basis points to 4.50%, as well as Fed Chairman Jerome Powell signaled that further rate hikes would be come through. On Friday, another Fed member, New York Fed President John Williams has reiterated the hawkish rhetoric, saying it remains possible the US central bank raises interest rates more than it currently expects next year. The Fed has projected the peak fed funds rate at 5.1%. On the economic data front, a series of downbeat data such as Manufacturing PMI, Services PMI, and S&P Global Composite PMI had below the expected reading, which indicates the contraction in the US private sector. With that, the Dollar Index has retreated some previous gains. However, the bearish economic data would be less likely to stop the Fed from hiking its rate, since the hawkish stance was declared. As of writing, the Dollar Index appreciated by 0.08% to 104.41.

In the commodities market, the crude oil price rose by 0.85% to $75.09 per barrel as of wirting following the officials claimed the US Energy Department will repurchase 3 million barrels of domestic crude oil for the Strategic Petroleum Reserve. On the other hand, the gold price edged up by 0.04% to $1791.50 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Dec) | 86.3 | 87.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

161222 Afternoon Session Analysis

16 December 2022 Afternoon Session Analysis

Pound plunged despite rate-hike plan remained.

The Pound Sterling, which was majorly traded by the global investors, plummeted significantly during the previous trading session after the Bank of England (BoE) raised the interest rate as widely expected. In the BoE Meeting, the Board of Committee lifted up the interest rate from 3.0% to 3.5%, in line with the consensus forecast. In further details, the BoE members is expecting the UK economy to be in recession for a prolonged period, while the inflationary pressure was expected to remain buoyed in the near-term future. Despite, the BoE agreed to continue its rate hike plan, whereby a 50-basis point is expected to be seen in the upcoming meeting. With that, it decremented the global demand over the pound market as the UK economy is trapped with prolonged recession. On top of that, the hawkish statement from the Federal Reserve Chairman Jerome Powell continues to be the main driven of the rising trend of dollar index, while pushing the pairing of GBP/USD lower yesterday. As of writing, the pair of GBP/USD rebounded slightly by 0.25% to 1.2205.

In the commodities market, the crude oil price slid by -0.45% to $76.00 per barrel as the strengthening of dollar index increased the cost of oil for non-US buyers. Besides, the gold prices dropped -0.05% to $1779.10 per troy ounce amid dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Nov) | 0.6% | 0.3% | – |

| 16:30 | EUR – German Manufacturing PMI (Dec) | 46.2 | 46.3 | – |

| 17:30 | GBP – Composite PMI | 48.2 | – | – |

| 17:30 | GBP – Manufacturing PMI | 46.5 | 46.5 | – |

| 17:30 | GBP – Services PMI | 48.8 | 49.2 | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.0% | 10.0% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0615. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0615, 1.0475

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.90.

Resistance level: 138.90, 141.75

Support level: 136.45, 134.15

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward resistance level at 0.9310.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1786.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1759.15.

Resistance level: 1786.00, 1807.85

Support level: 1759.15, 1729.85

161222 Morning Session Analysis

16 December 2022 Morning Session Analysis

US Dollar skyrocketed as hawkish stance implied.

The Dollar index which traded against a basket of six major currencies surged on yesterday as Fed emphasized its aggressive rate hike stance. The US central bank raised its interest rate by 50 basis point to 4.50% in early Thursday, after four consecutive 75 basis point hikes. In the Press Conference, the Federal Reserve Chairman Jerome Powell reiterated that the current inflation data was not enough to convince Fed to turn its stance, even economy slips toward a possible recession, which hinted that further rate hike might be implemented. The Fed projected continued rate hikes to above 5% in 2023, a level not seen since a steep economic downturn in 2007. On the economic data front, a series of downbeat data has limited the gains of US Dollar. According to Census Bureau, the US retail sales fell more than expected in November, while the US Philadelphia Fed Manufacturing Index was also disappointed most of market participants. The pessimistic economy outlook has stoked a shift in sentiment toward other currencies which provided a better return. As of writing, the Dollar Index rose by 0.77% to 104.21.

In the commodities market, the crude oil price edged up by 0.11% to $76.20 per barrel as of writing after the sharp decline throughout overnight trading session following the Canada’s TC Energy Corp was resuming operations in a section of its Keystone pipeline. In addition, the gold price dropped by 0.05% to $1776.62 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Nov) | 0.6% | 0.3% | – |

| 16:30 | EUR – German Manufacturing PMI (Dec) | 46.2 | 46.3 | – |

| 17:30 | GBP – Composite PMI | 48.2 | – | – |

| 17:30 | GBP – Manufacturing PMI | 46.5 | 46.5 | – |

| 17:30 | GBP – Services PMI | 48.8 | 49.2 | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.0% | 10.0% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1725.35

151222 Afternoon Session Analysis

15 December 2022 Afternoon Session Analysis

Aussie dollar slumped despite upbeat employment data.

The Australian dollar, which widely known as Aussie, seesawed during the Asian early trading session amid mixed market sentiment. Earlier today, the Australian Bureau of Statistics reported its Employment Change data for the month of November with a stronger-than-expected reading, where it came in at 64.0K, significantly higher than the consensus forecast at 19.0K. The upbeat data showed that the nation’s labor market remained resilient despite sky-high inflation issue persists. However, the Aussie dollar was pressured by huge bearish momentum after China released a downbeat economic data. According to the China’s National Bureau of Statistics, the China Industrial Production data for November declined from 5.0% to 2.2%, weaker than the consensus forecast at 3.6%. The significant drop was mainly attributed to the stricter lockdown measure, which implemented by the local government throughout the month with an aim of curbing the spread of Covid-19. As of writing, the pair of AUD/USD dropped by -0.33% to 0.6845.

In the commodities market, the crude oil price slid by -0.90% to $76.85 per barrel as US crude oil inventories see huge inventory build in the past one week. According to the EIA, US Crude Oil Inventories came in at 10.231M while the consensus forecast was -3.595M. Besides, the gold prices dropped -0.89% to $1795.30 per troy ounce follow the rebound of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q4) | 0.50% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Dec) | 3.00% | 3.50% | – |

| 21:15 | EUR – Deposit Facility Rate (Dec) | 1.50% | 2.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Dec) | 1.50% | 2.50% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Nov) | 1.3% | 0.2% | – |

| 21:30 | USD – Initial Jobless Claims | 230K | 230K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Dec) | 4.50 | -1.00 | – |

| 21:30 | USD – Retail Sales (MoM) (Nov) | 1.3% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level at 103.15.

Resistance level: 104.95, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2345. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2470.

Resistance level: 1.2470, 1.2645

Support level: 1.2345, 1.2200

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0615. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0615, 1.0475

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 136.45. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6460. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 80.60.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1807.85. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1786.00.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15

151222 Morning Session Analysis

15 December 2022 Morning Session Analysis

US Dollar dived despite Fed keeps hawkish tone.

The Dollar Index which traded against basket of six major currencies dropped significantly despite the hawkish statement from Fed Chairman. According to Reuters, the Federal Reserve Chairman Jerome Powell claimed on FOMC Press Conference that the recent inflation data was not enough to change its outlook for inflation yet, although the CPI data has shown that the inflation risk in the US was cooling down. Besides, the US central bank’s projection of the target federal funds rate rising to 5.1% in 2023, which is slightly higher than investors expected heading into this week’s two-day policy meeting. With that, the Dollar Index has skyrocketed immediately after the speech has been unleashed. Nonetheless, the Dollar Index has remained its bearish movement, as market participants remain skeptical that the Federal Reserve will continue to raise interest rates aggressively. According to Fed Rate Monitor Tool, the likelihood of 25 basis point rate hike in the February meeting has reached 95%, whereas the chance of half a percentage point rate increase was about 5%. As of writing, the Dollar Index depreciated by 0.32% to 103.24.

In the commodities market, the crude oil price edged down by 0.14% to $77.17 per barrel as of writing following the Canada’s TC Energy Corp claimed that it expected to give an update on the Keystone pipeline restart later on Wednesday. On the other hand, the gold price eased by 0.06% to $1806.71 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q4) | 0.50% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Dec) | 3.00% | 3.50% | – |

| 21:15 | EUR – Deposit Facility Rate (Dec) | 1.50% | 2.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Dec) | 1.50% | 2.50% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Nov) | 1.3% | 0.2% | – |

| 21:30 | USD – Initial Jobless Claims | 230K | 230K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Dec) | 4.50 | -1.00 | – |

| 21:30 | USD – Retail Sales (MoM) (Nov) | 1.3% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.50, 104.90

Support level: 102.05, 100.55

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2735

Support level: 1.2335, 1.2135

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6960, 0.7095

Support level: 0.6830, 0.6705

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

141222 Afternoon Session Analysis

14 December 2022 Afternoon Session Analysis

Pound Sterling eased as economic recession issues remained.

The GBP/USD, which widely traded by global investors retreated from its recent high despite the easing inflationary risk in the US. According to Office for National Statistics, the UK Average Earnings Index +Bonus came in at the reading of 6.1%, missing the consensus forecast of 6.2%. Besides, the UK Claimant Count Change for November notched up from the reading of -6.4K to 30.5K, exceeding the market expectation of 3.5K. These weak economic figures confirmed the fact that the UK economy is slowing down, which dragged down the appeal of Pound Sterling. In addition, the Bank of England (BoE) governor Andrew Bailey claimed in its Financial Stability Report yesterday that the UK economy has been deteriorated, while UK household being pressured by rising interest rate and soaring inflation. With that, the aggressive tightening monetary policy would less likely to be carried out during upcoming meeting. As of now, the announcement of UK CPI that scheduled on later 3.00pm would provide a clearer view for interest rate decision from BoE. As of writing, the GBP/USD depreciated by 0.04% to 1.2349.

In the commodities market, the crude oil price slipped by 0.33% to $75.16 per barrel as of writing over the increasing of crude oil stock. According to API, the US API Weekly Crude Oil Stock rose by 7.819M barrels, far higher than the market expectation. On the other hand, the gold price dropped by 0.15% to $1811.24 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Nov) | 11.1% | 10.9% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -5.187M | -3.595M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2735

Support level: 1.2335, 1.2135

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6960, 0.7095

Support level: 0.6830, 0.6705

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50

141222 Morning Session Analysis

14 December 2022 Morning Session Analysis

Greenback plunged as inflation eased.

The dollar index, which traded against a basket of six major currencies, recorded huge losses yesterday as the US inflation data came in at a softer than expected reading. According to the US Labor Department, the goods and services prices in the nation rose less than expected in November, mirroring the sign that the inflation was being well-controlled following a series of rate hike since early of this year. The Consumer Price Index (CPI) rose by 7.1% from a year ago, missing the consensus forecast at 7.3%, while the core CPI, which excluding volatile food and energy prices rose 0.2% on the month, compared with the estimates of 0.3%. The cooling inflation boosted the risk on sentiment of the market as it take pressure off the Fed for raising larger rate for longer period of time. Despite, it is noteworthy to emphasize that the current inflation rate is still far away from the Fed’s 2% long-term inflation target. At this juncture, the market participants are eyeing on the Fed interest rate decision, which scheduled to announce in the early morning on 15th Dec. As of writing ,the dollar index dropped by -1.07% to 104.00.

In the commodities market, crude oil prices skyrocketed by 3.54% to $75.25 per barrel as there is no timeline for a restart of the Keystone pipeline as of now. On top of that, the slumping of the Greenback urged the global investors to buy into the oil market with a lowest cost. Besides, gold prices appreciated by 0.10% to $1810.10 per troy ounce as the US dollar weakened on softer inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Nov) | 11.1% | 10.9% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -5.187M | -3.595M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 105.00. However, MACD which illustrated bullish bias momentum suggests the index to undergo technical correction in short term.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2345. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0615. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0615, 1.0475

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 136.45. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6460. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 71.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 76.10.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1806.35. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1806.35, 1786.00

131222 Afternoon Session Analysis

13 December 2022 Afternoon Session Analysis

Pound Sterling rose amid optimistic GDP data.

The GBP/USD, which widely traded by global investors edged up on yesterday amid the upbeat economic data. According to Office for National Statistics, the UK Gross Domestic Product (GDP) MoM has notched up from the previous reading of -0.6% to 0.5%, exceeding the consensus expectation of 0.4%. Besides that, the UK Manufacturing Production MoM for October raised from the prior figures of 0.0% to 0.7%. With such background, the market optimism toward economic progression in the UK has been dialed up, as the data shown has outweighed the market concerns of recession that faced by the UK. Though, the gains that experienced by Pound Sterling was limited following the Bank of England (BoE) was widely expected to scale back its rate hike pace, after its outsized 75 basis point hike in November amid growing signs of a prolonged downturn. According to the BoE’s estimation, the UK will remain in recession throughout next year and the first half of 2024. The bank also forecasted at the November meeting that the UK economy would contract by 0.3% in the fourth quarter. As of writing, the GBP/USD eased by 0.01% to 1.2269.

In the commodities market, the crude oil price appreciated by 1.18% to $74.04 per barrel as of writing following the expectation of loosening Covid-19 restriction in China boosted up the demand of oil. On the other hand, the gold price rose by 0.16% to $1784.28 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Oct) | 6.0% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Nov) | 3.3K | 3.5K | – |

| 15:00 | EUR – German CPI (YoY) (Nov) | 10.0% | 10.0% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Dec) | -36.7 | -26.4 | – |

| 21:30 | USD – Core CPI (MoM) (Nov) | 0.3% | 0.3% | – |

| 21:30 | USD – CPI (YoY) (Nov) | 7.7% | 7.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2335, 1.2485

Support level: 1.2135, 1.1955

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1733.70

131222 Morning Session Analysis

13 December 2022 Morning Session Analysis

Greenback slumped despite inflation pressure persists.

The dollar index, which traded against a basket of six major currencies, lost its ground and plunged to the one week low despite last Friday’s inflation figure showed inflation persists in the nation. During the later session of last Friday, US Bureau of Labor Statistics reported its Produce Price Index (PPI) data for November at a reading of 0.3%, slightly higher than the consensus forecast at 0.2%. With that, it reversed the market sentiment in the dollar market as it stumbled the market optimism over the cooling down of inflation. The headline of higher-than-expected PPI sparked the chances that the Federal Reserve would implement larger rate hike for longer to tackle the sky-high inflation effectively. Nonetheless, the sell-off of Greenback was resumed after UK posted a brilliant economic performance over the past one month. According to the Office for the National Statistics, the UK GDP data jumped from -0.6% to 0.5% over the past one month, beating the consensus forecast at 0.4%. As of writing, the pair of GBP/USD inclined by 0.02% to 1.2270.

In the commodities market, crude oil prices skyrocketed by 2.45% to $73.65 per barrel after last week recession-related sell off. With the Keystone pipeline between the US and Canada remained closed, it is still threatening the supply side of the oil market. Besides, gold prices appreciated by 0.89% to $1781.05 per troy ounce as the US dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Oct) | 6.0% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Nov) | 3.3K | 3.5K | – |

| 15:00 | EUR – German CPI (YoY) (Nov) | 10.0% | 10.0% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Dec) | -36.7 | -26.4 | – |

| 21:30 | USD – Core CPI (MoM) (Nov) | 0.3% | 0.3% | – |

| 21:30 | USD – CPI (YoY) (Nov) | 7.7% | 7.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 105.00. However, MACD which illustrated bullish bias momentum suggests the index to undergo technical correction in short term.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0475. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 136.45. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 138.90.

Resistance level: 138.90, 141.75

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6355.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9405.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 71.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 76.10.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1786.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1806.35, 1835.30

Support level: 1786.00, 1759.15

091222 Afternoon Session Analysis

9 December 2022 Afternoon Session Analysis

Yen surged following upbeat GDP figures.

The USD/JPY, which widely traded by global investors dropped significantly throughout overnight trading session after the bullish economic data has been released. According to the Japan Cabinet Office, the Japan Gross Domestic Product (GDP) QoQ for third quarter posted at the reading of -0.2%, exceeding the market forecast of -0.3%. The economic condition that better than consensus expectations has dialed up the market optimism toward economic progression in Japan, which spurring bullish momentum on the Japanese Yen. Besides that, the pairing extended its losses over the fragile labor market in the US. Yesterday, the US Department of Labor had announced the downbeat Initial Jobless Claims data, while it sparked the hopes that a lower rate hike in the December interest rate decision might be implemented. With that, it dragged down the appeal of US Dollar. At this juncture, investors are highly eyeing on the announcement of PPI data in order to gauge the likelihood movement of the pairing. As of writing, the USD/JPY depreciated by 0.60% to 135.83.

In the commodities market, the crude oil price raised by 0.95% to $72.13 per barrel as of writing following the Canada’s TC Energy shut its Keystone pipeline for maintenance. On the other hand, the gold price rose by 0.32% to $1794.87 per troy ounce as of writing over the value of US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – PPI | 0.2% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2485, 1.2735

Support level: 1.2245, 1.2040

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 73.80, 77.40

Support level: 70.45, 67.75

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

091222 Morning Session Analysis

9 December 2022 Morning Session Analysis

Greenback dipped amid the worsening of labor data.

The dollar index, which was traded against a basket of six major currencies, lost its ground while receiving some sell-off pressures after US released a downbeat labor data. According to the Department of Labor, US Initial Jobless Claims came in at 230K, in line with the consensus expectation, but still refreshed the highest record since early of February 2022. The increase in the recurring application for US unemployment benefits showed that the labor market is experiencing the tentative signs of cooling. With that, the investors interpreted the data as a sign that Fed would likely slowdown the pace of rate hikes soon, which diminished the appeal of the dollar index. Nonetheless, the market attention is now gathered on the next US inflation data point, which is the Friday night’s Producer Price Index (PPI) for the month of November. The data will be on watch by all the investors as it would provide a clear sign of the inflationary pressures in the US. As of writing, the dollar index dropped -0.28% to 104.80.

In the commodities market, the crude oil price edged down -0.34% to $72.25 per barrel as the market concern over the global economic slowdown overshadowed the issue of Keystone pipeline outage. Besides, the gold prices jumped 0.16% to $1789.05 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – PPI | 0.2% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 105.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 106.65, 107.95

Support level: 105.00, 103.15

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0475. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 72.35. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 76.10, 80.60

Support level: 72.35, 66.25

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1766.50. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15