151122 Afternoon Session Analysis

15 November 2022 Afternoon Session Analysis

Japanese Yen slumped amid downbeat GDP data.

The Japanese Yen, which is majorly traded by global investors, experienced a huge sell-off pressure right after the downbeat GDP data was released this morning. According to Japan’s Cabinet Office, the GDP for the third quarter of 2022 came in at -0.3%, far lower than the consensus forecast of 0.3%, mirroring that Japan’s economy was still trapped in the recessionary stage. The unexpected shrinking of the economy was mainly attributed to the yen’s historic slide, which had battered growth momentum, leaving the country’s recovery from the pandemic in a vulnerable spot. Despite this, the future outlook of the Japanese economy turns brighter as the reopening of Japan’s borders is expected to spur the country’s tourism sector. On the other side, the dollar index was boosted by the hawkish-titled comment from the Fed’s member – Christopher Waller. He emphasized that there is no sign showing that inflation will continue to drop going forward, and it is too early to call victory on the battle against inflation. As of writing, the pair of USD/JPY rose 0.39% to 140.40.

In the commodities market, the crude oil price rebounded by 0.65% to $86.05 per barrel after plummeting significantly yesterday. Recently, the daily Covid-19 cases in China shot up and triggered market fears over the risk of renewed lockdown measures. Besides, the gold price dropped -0.01% to $1771.05 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Sep) | 6.0% | 6.0% | – |

| 15:00 | GBP – Claimant Count Change (Oct) | 25.5K | – | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Nov) | -59.2 | -50.0 | – |

| 21:00 | USD – PPI (MoM) (Oct) | 0.4% | 0.5% | – |

Technical Analysis

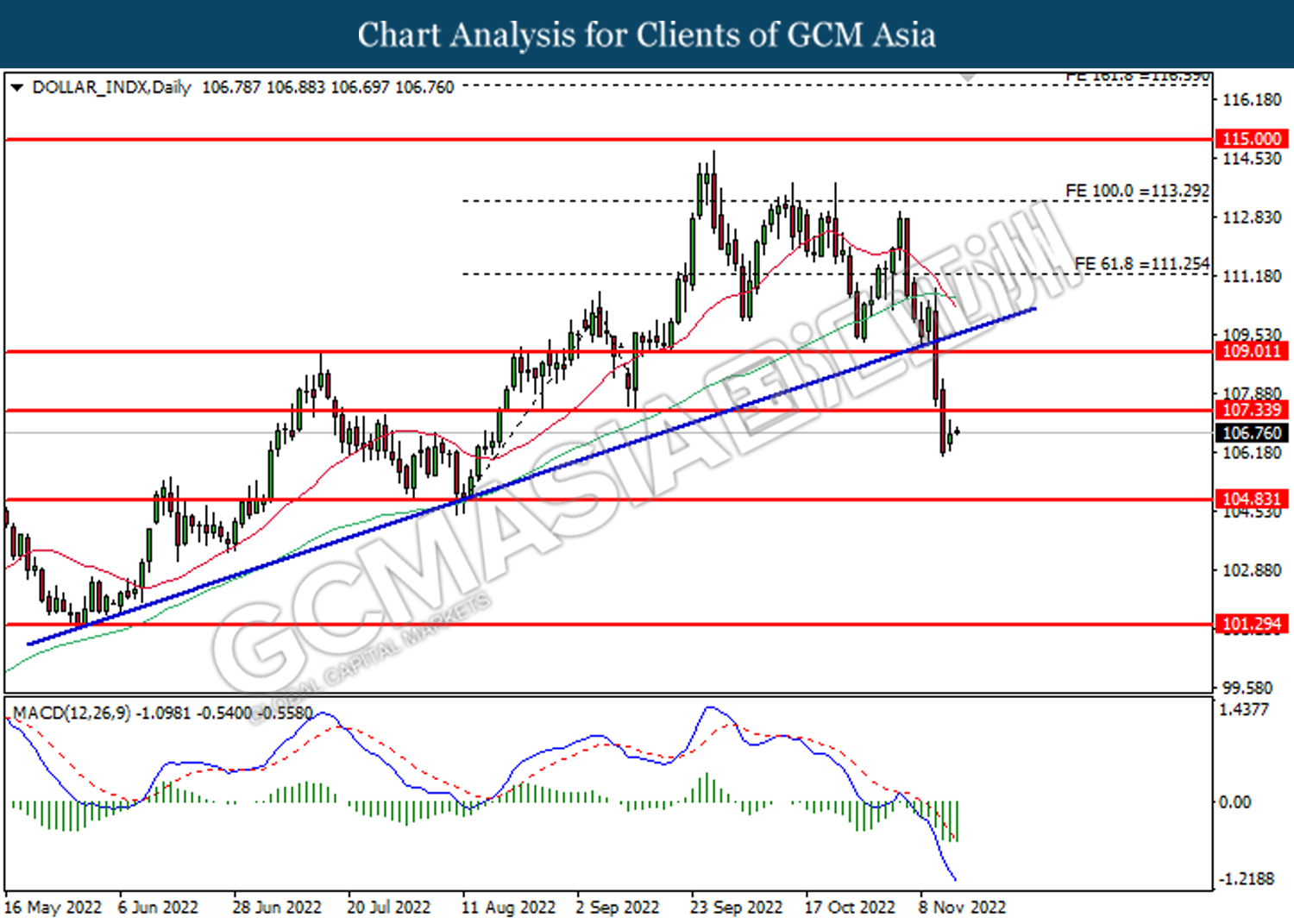

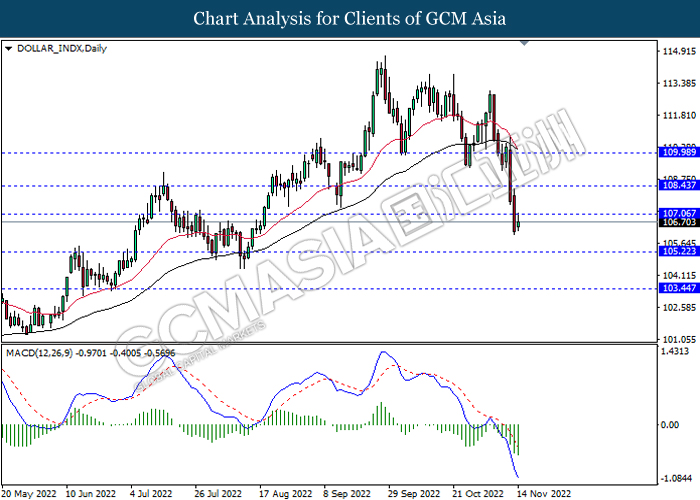

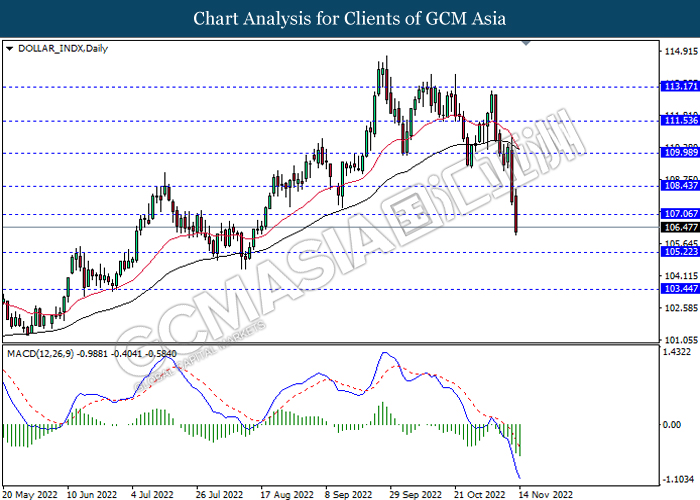

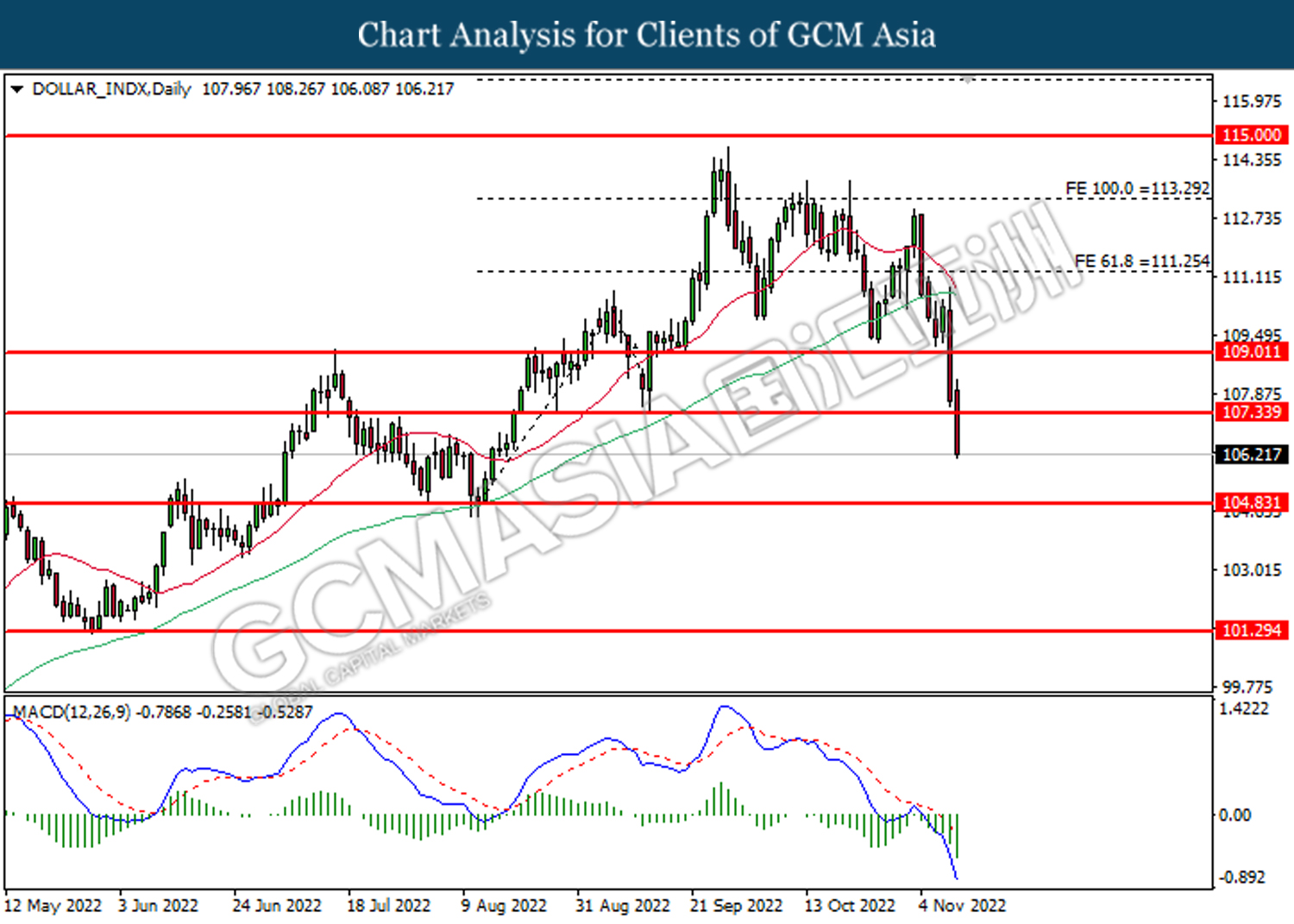

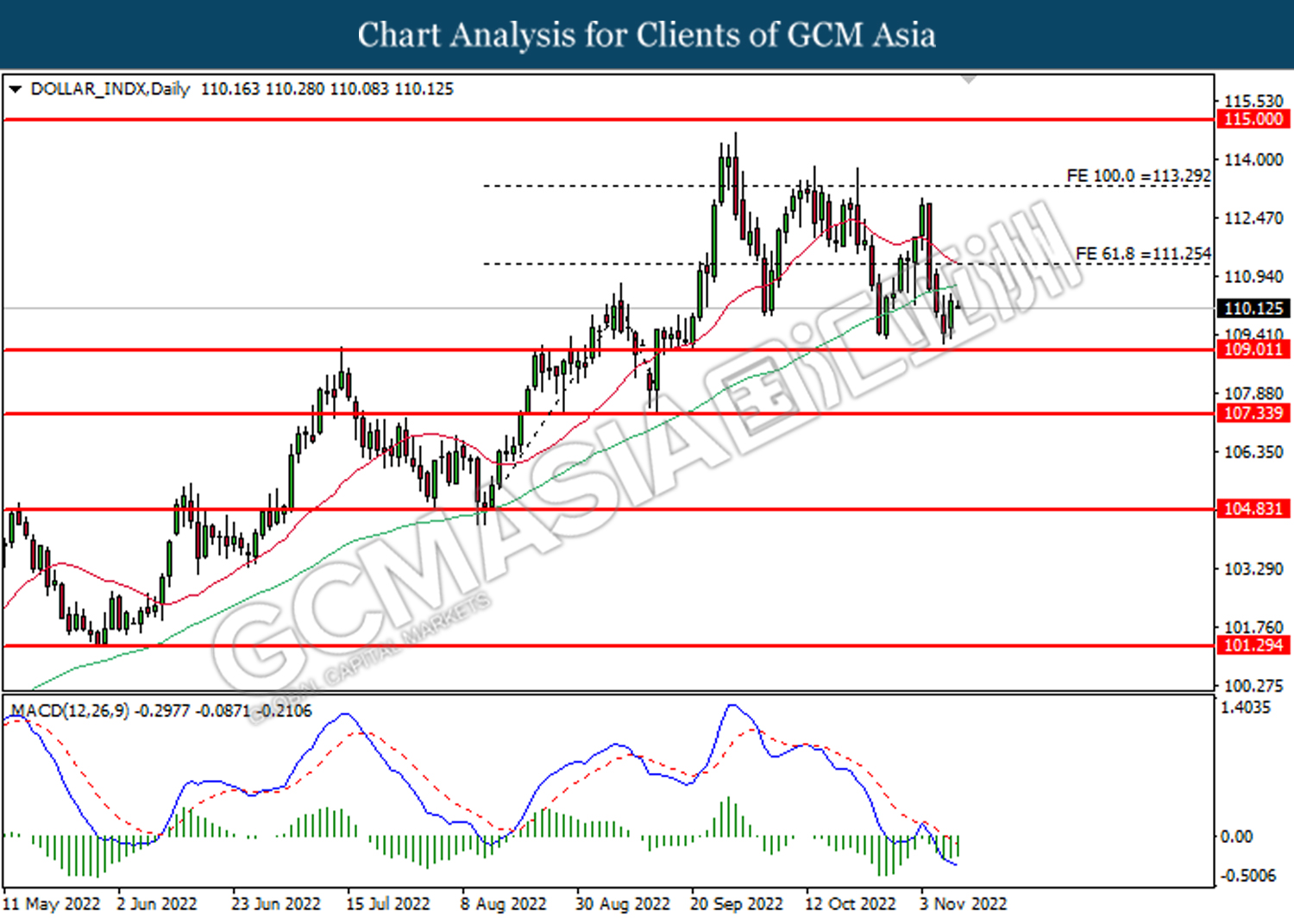

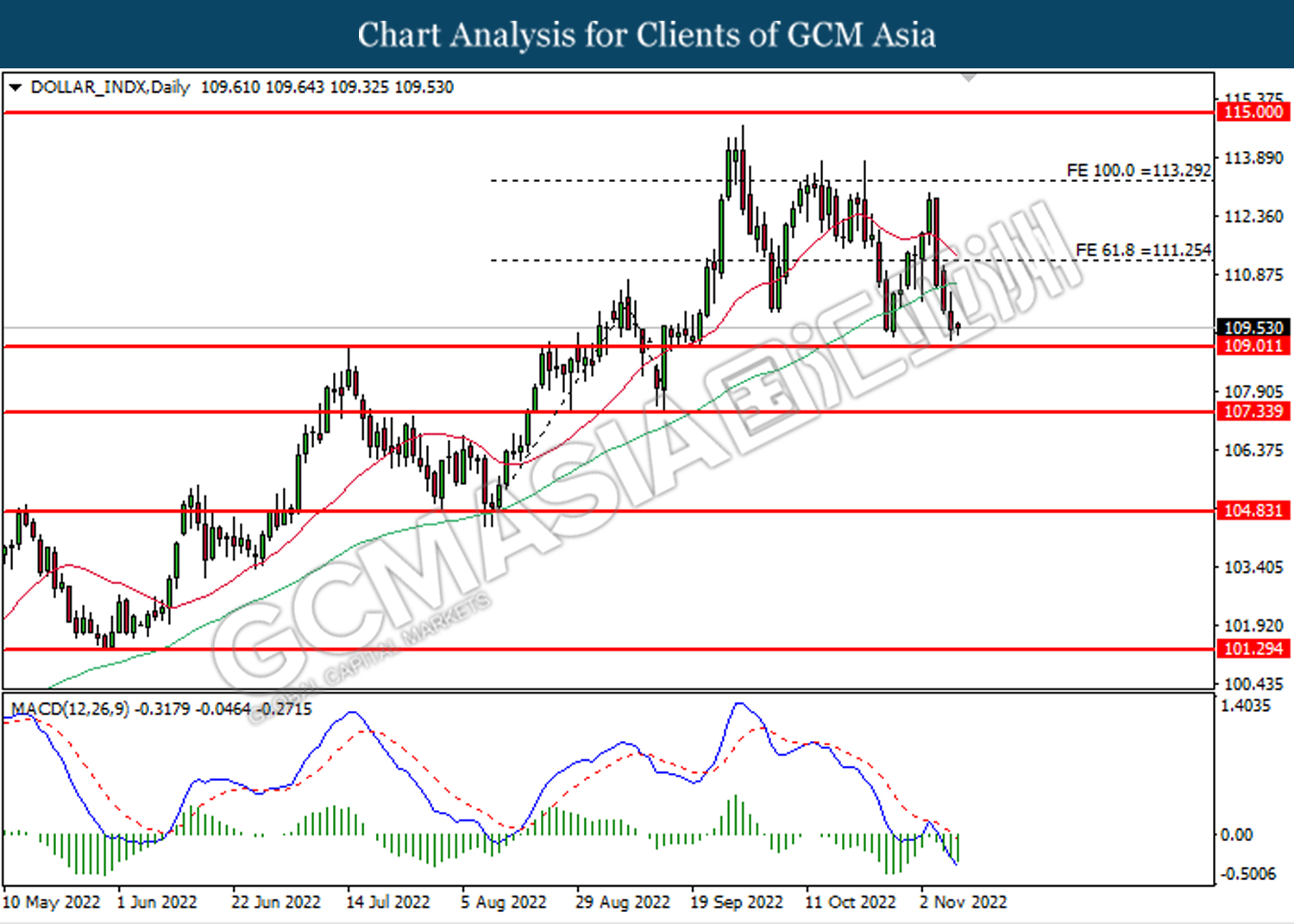

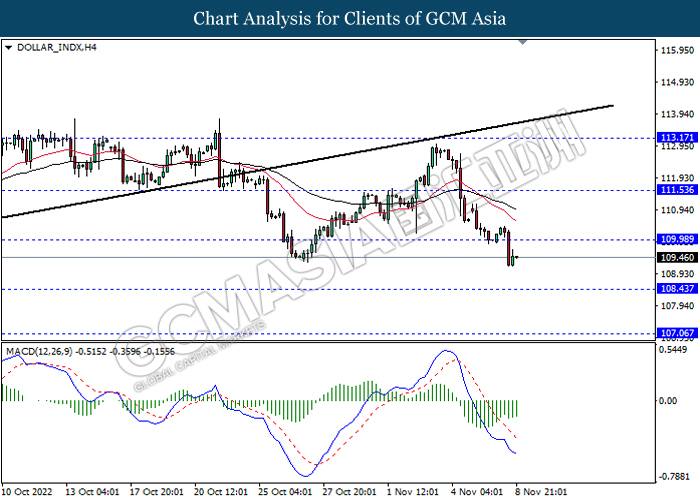

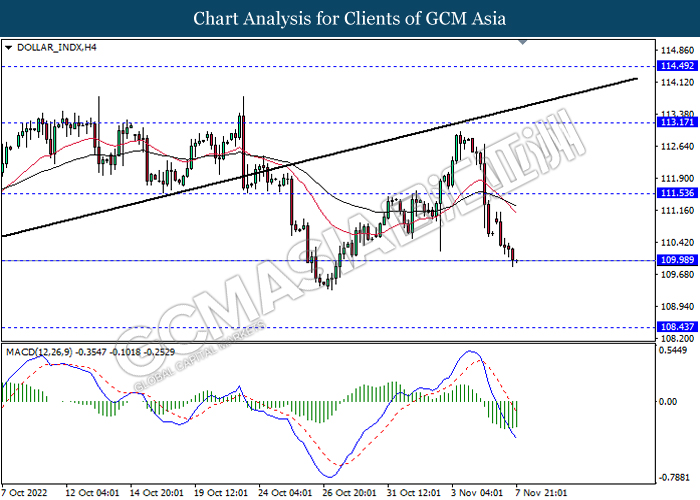

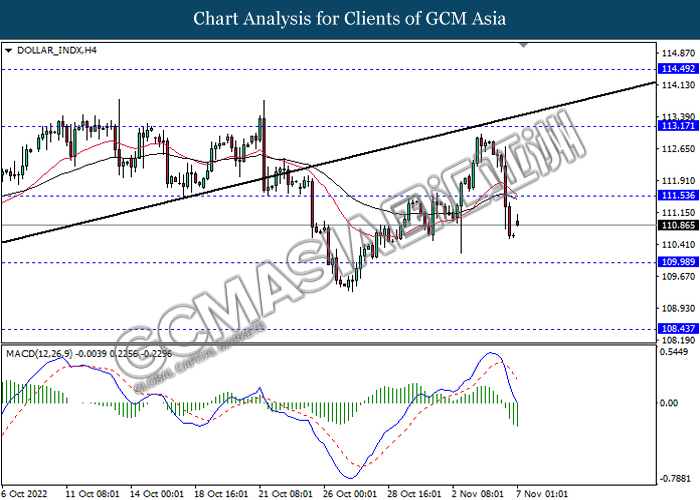

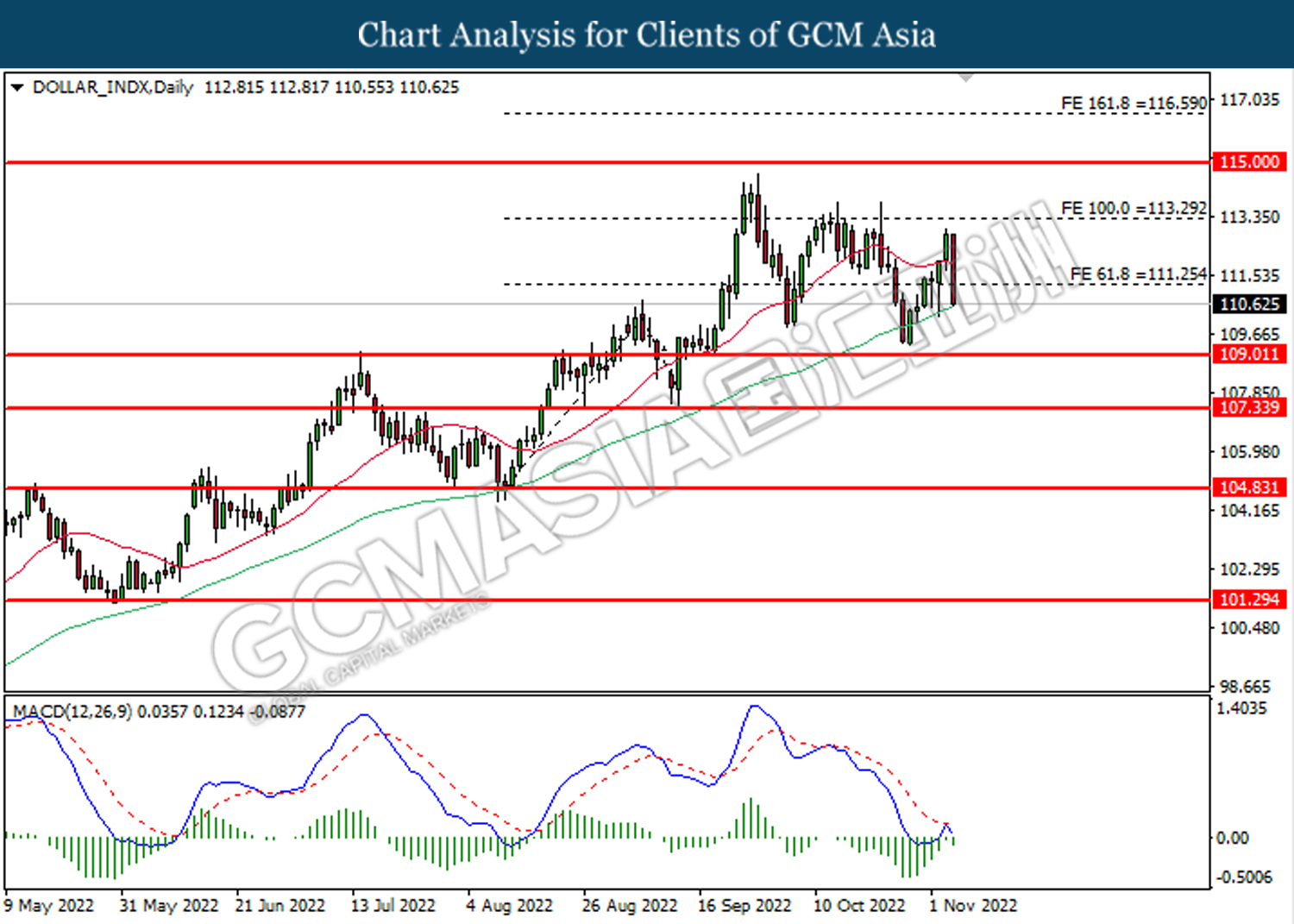

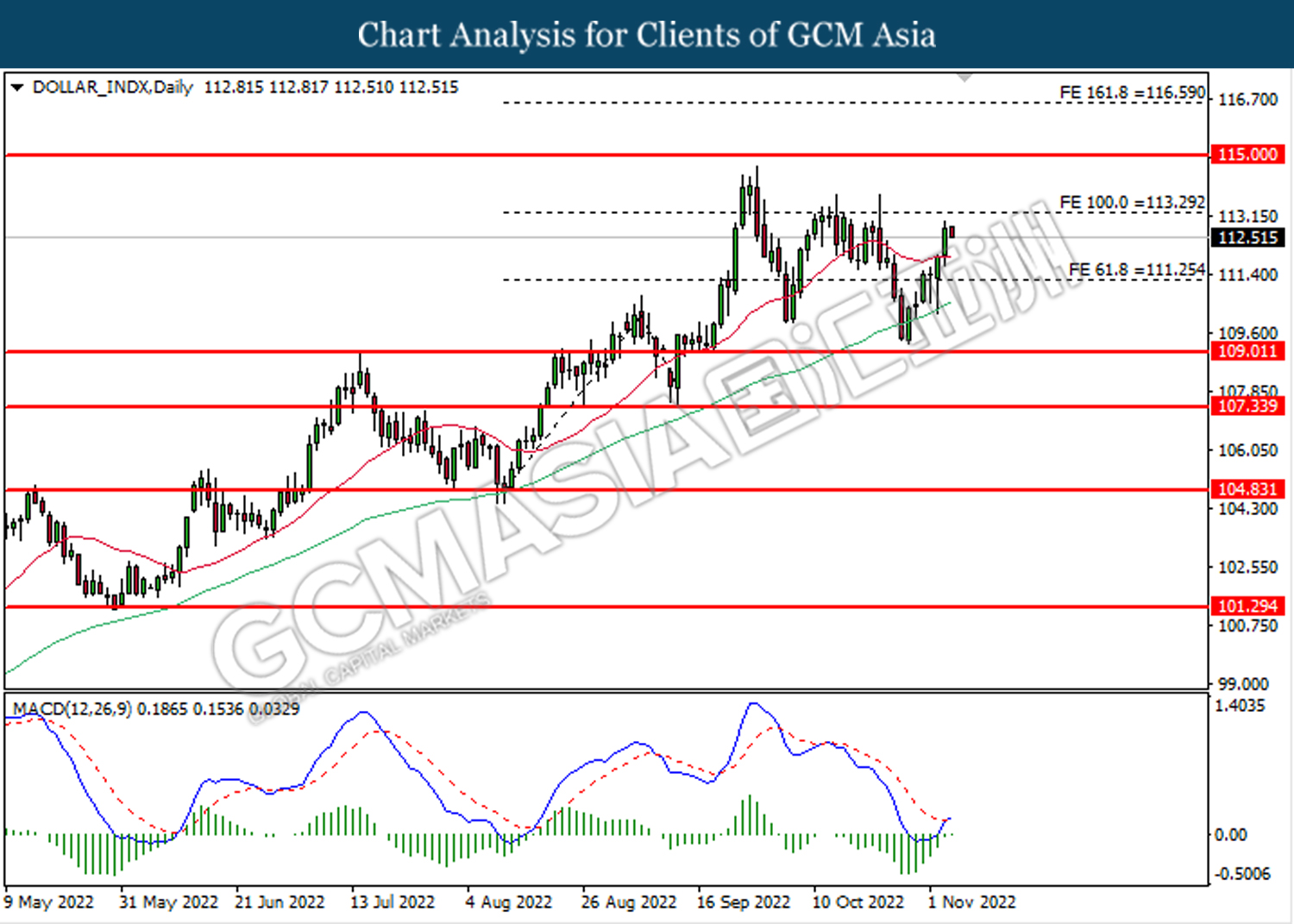

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

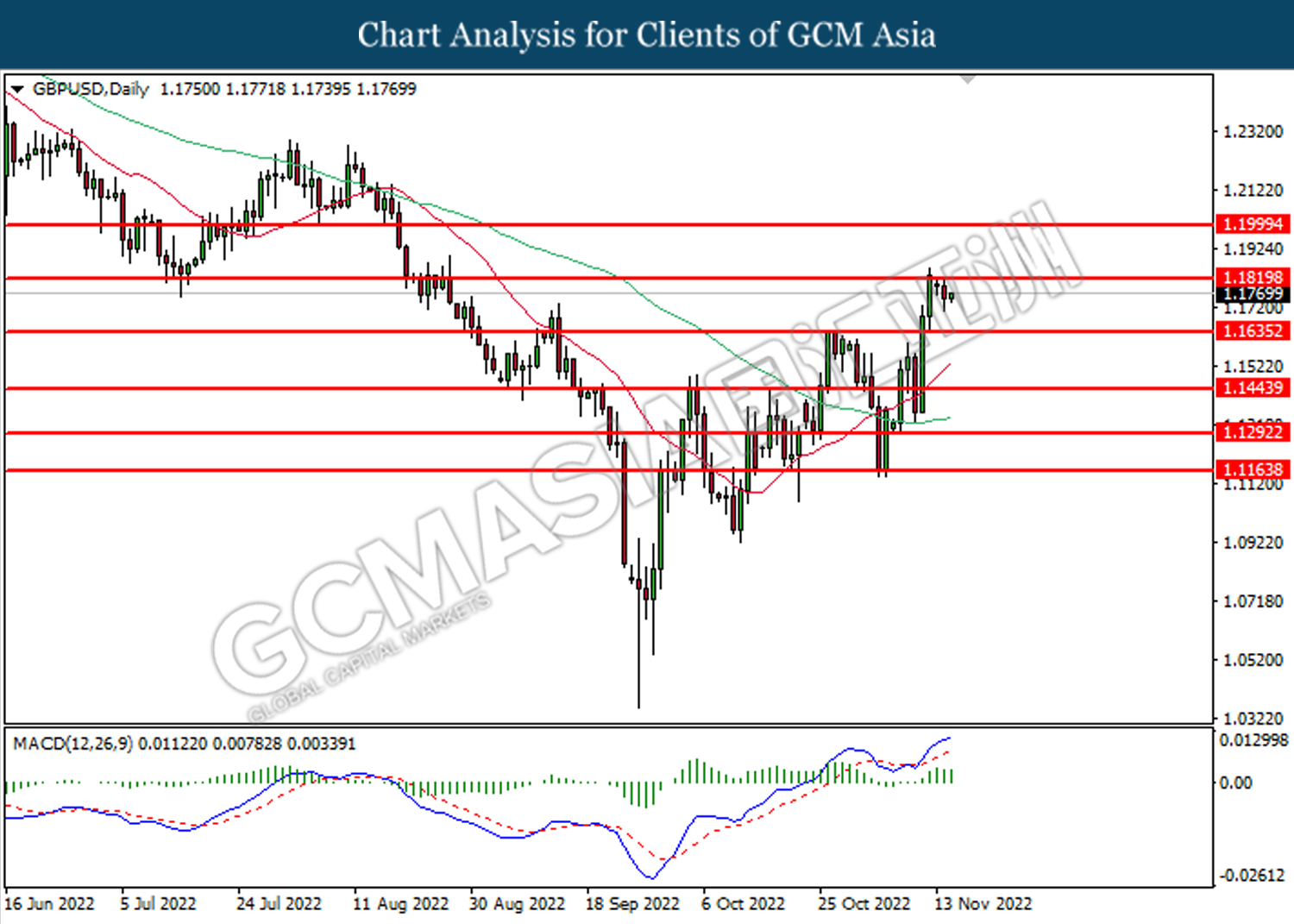

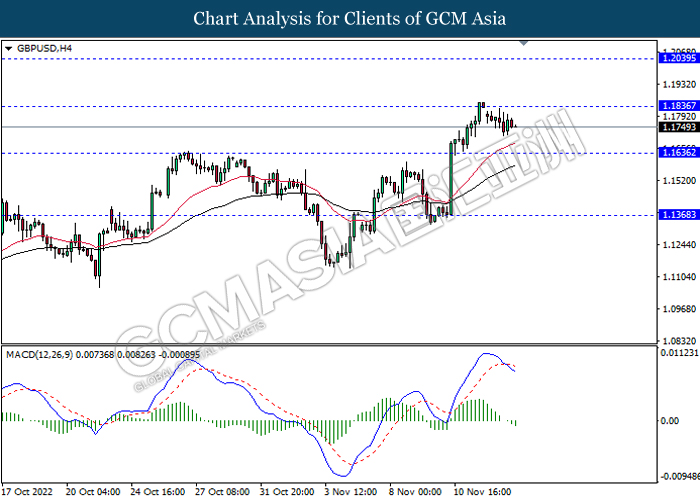

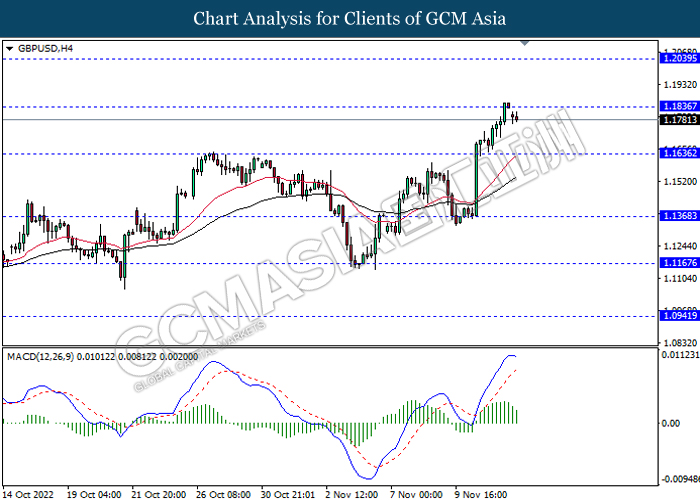

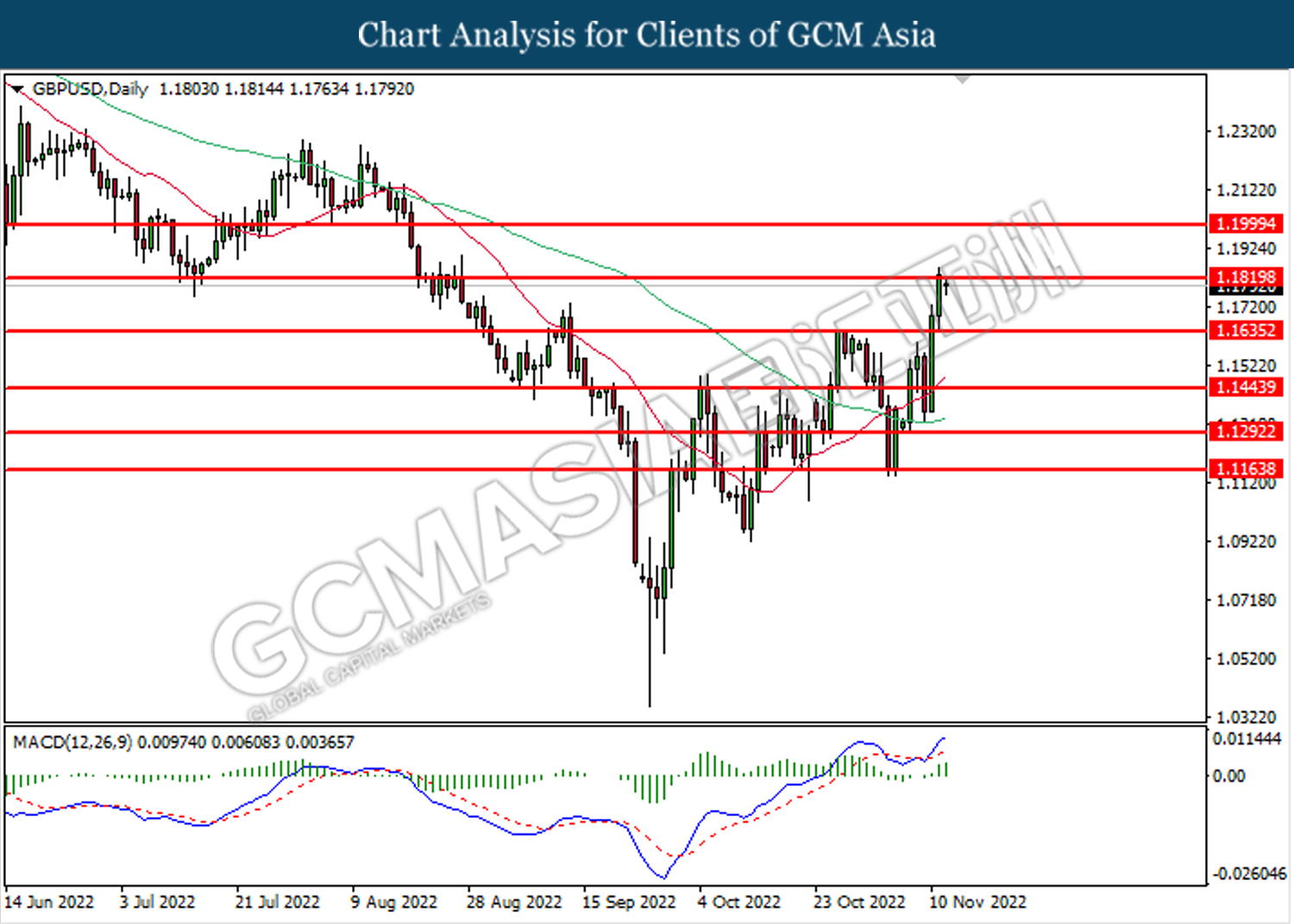

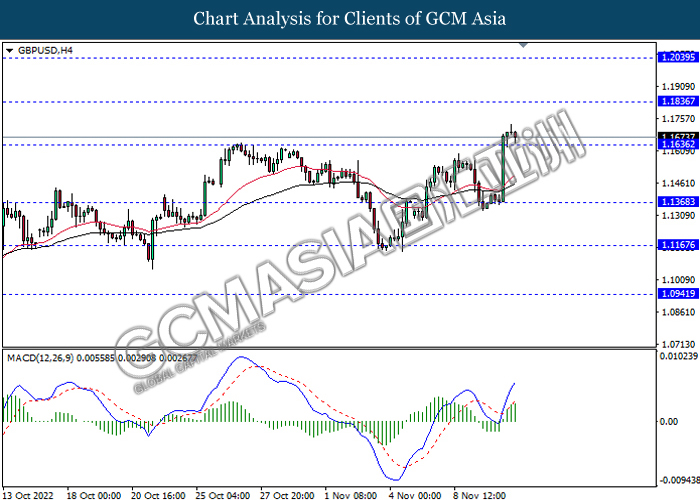

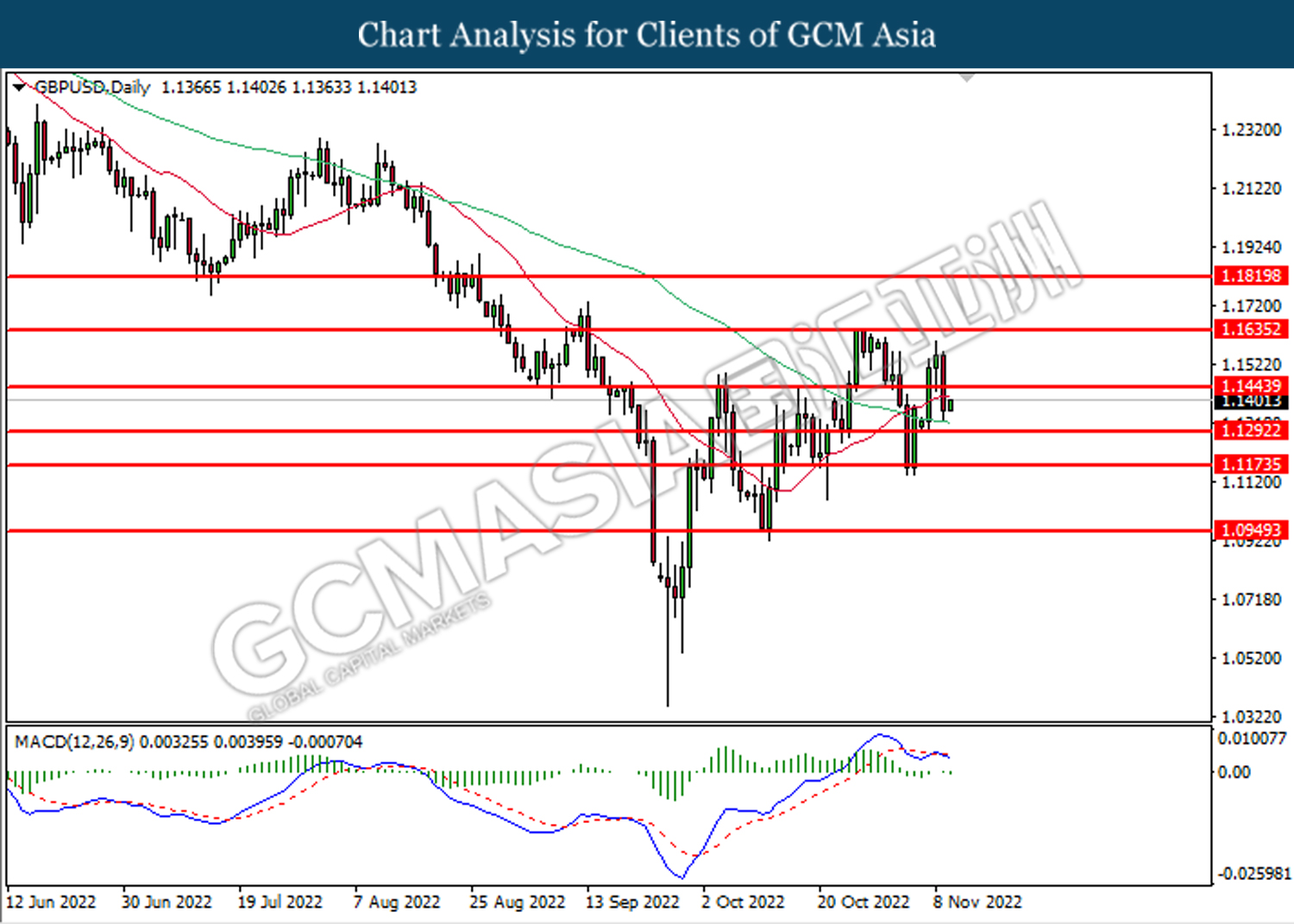

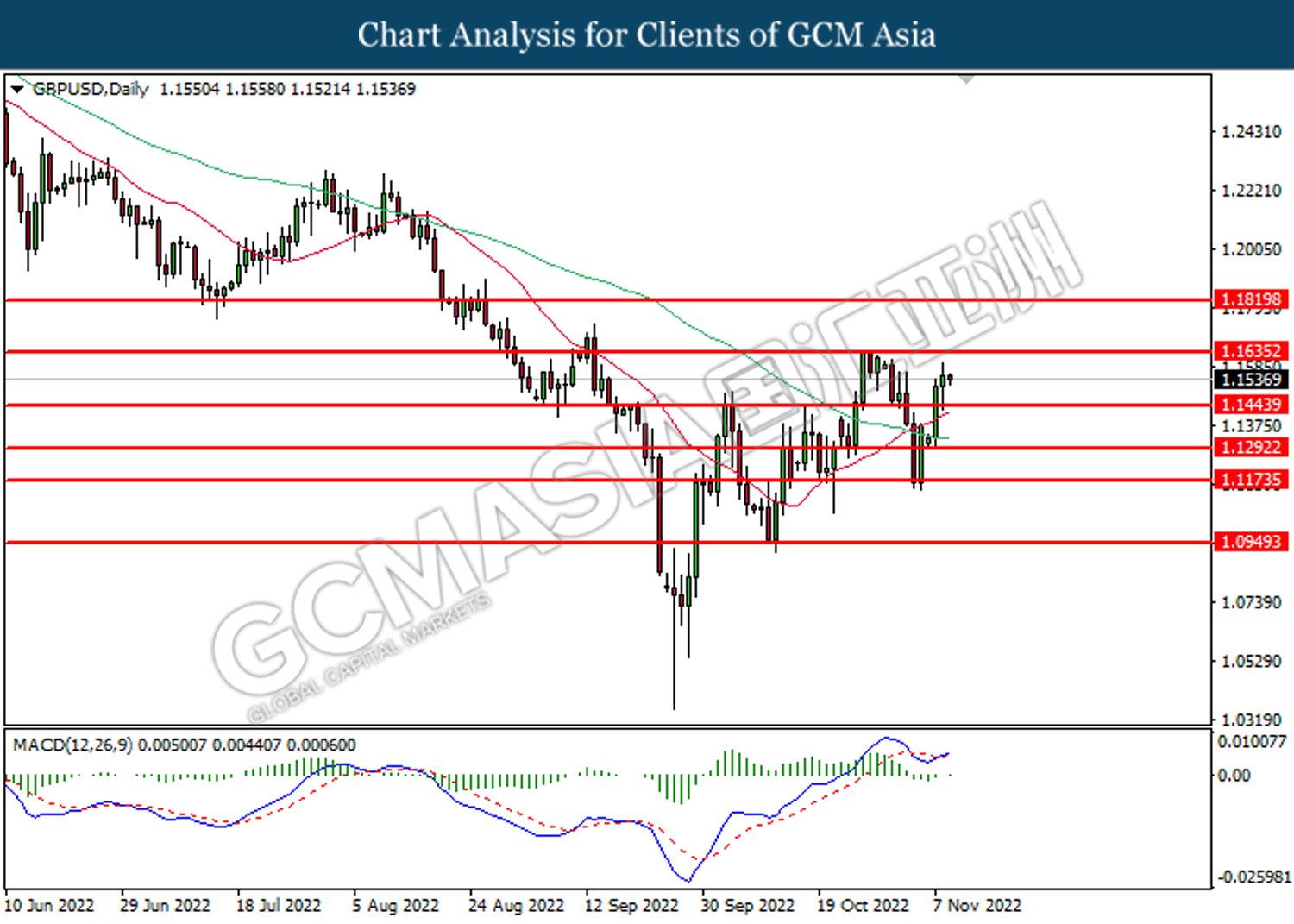

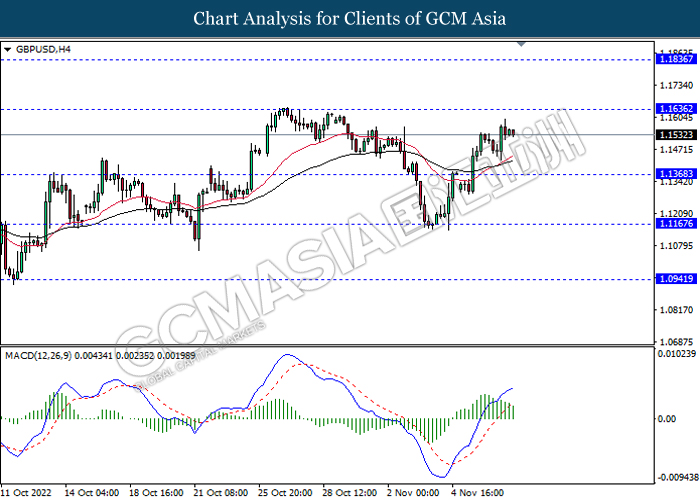

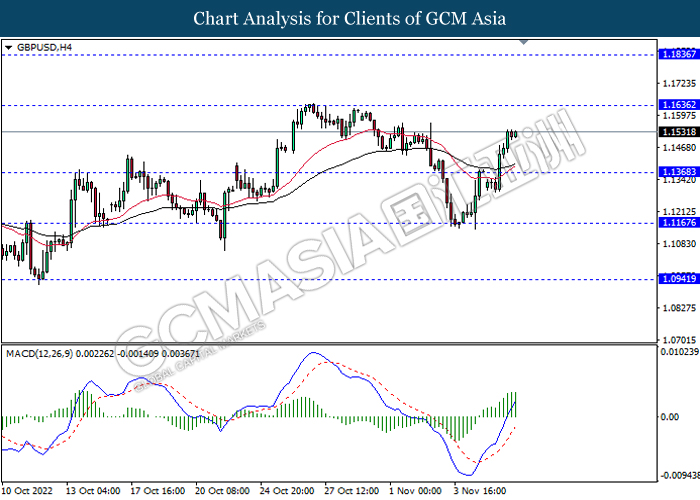

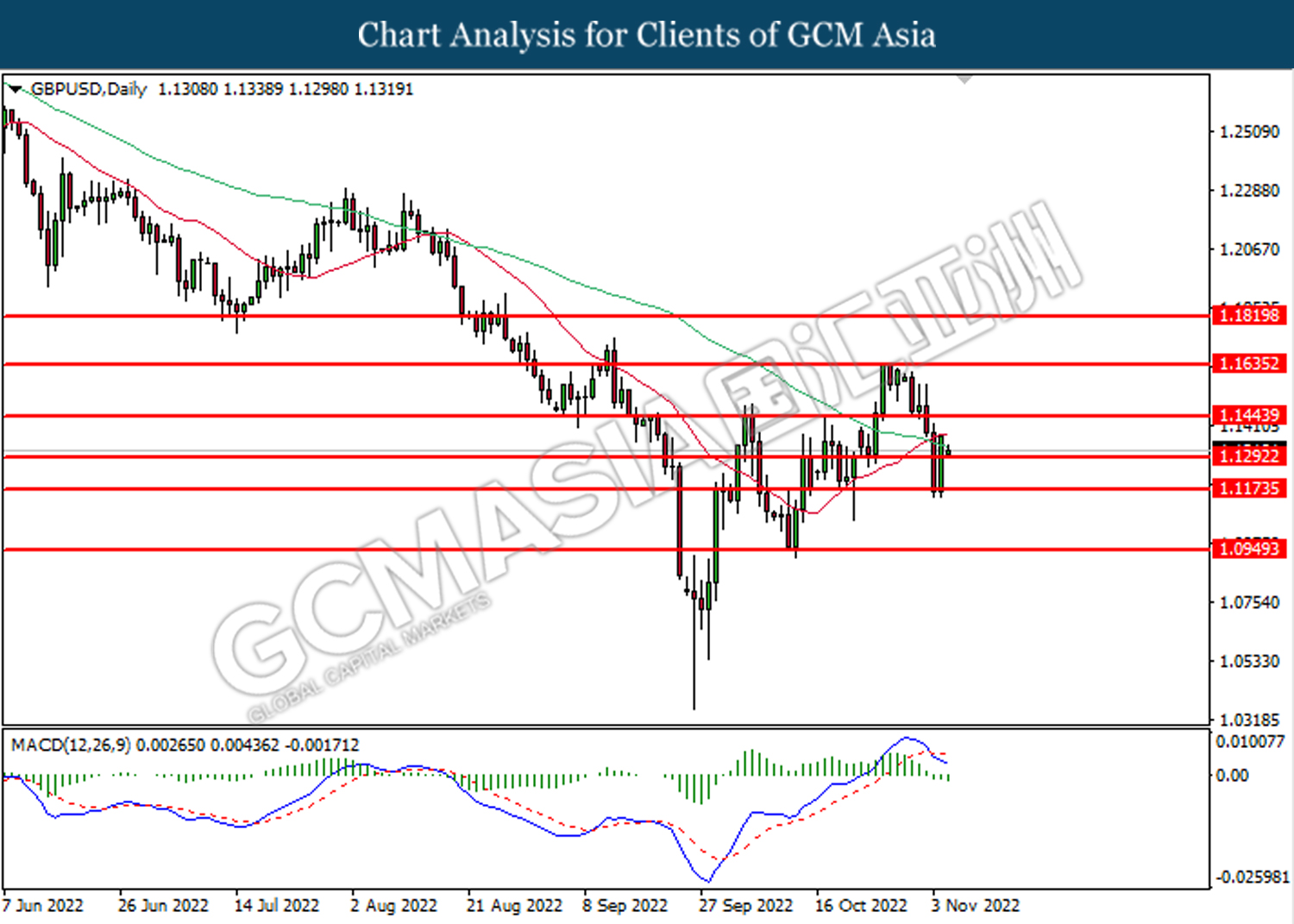

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1820, 1.2000

Support level: 1.1635, 1.1445

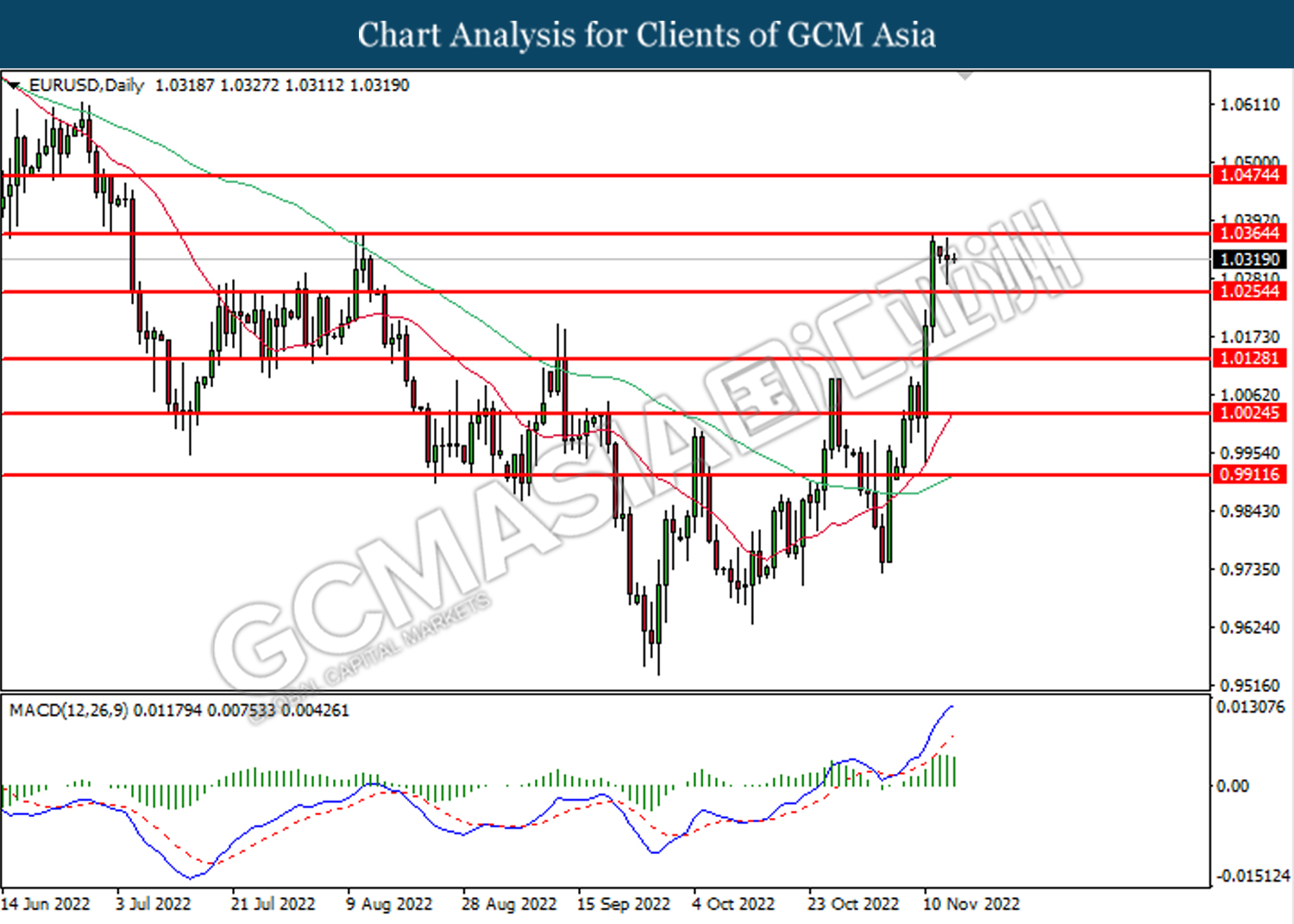

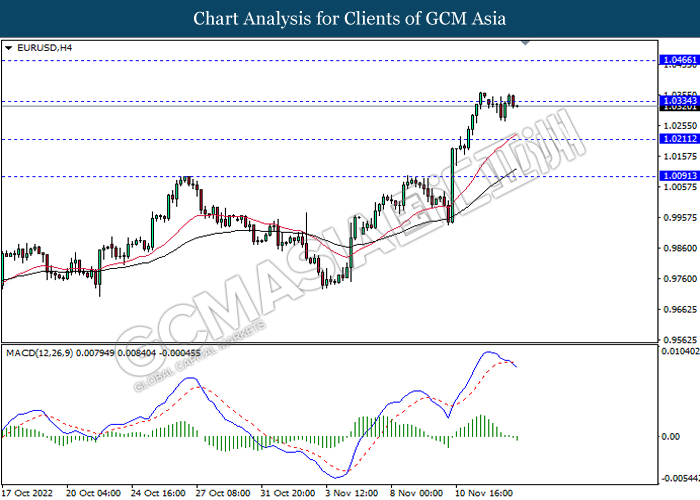

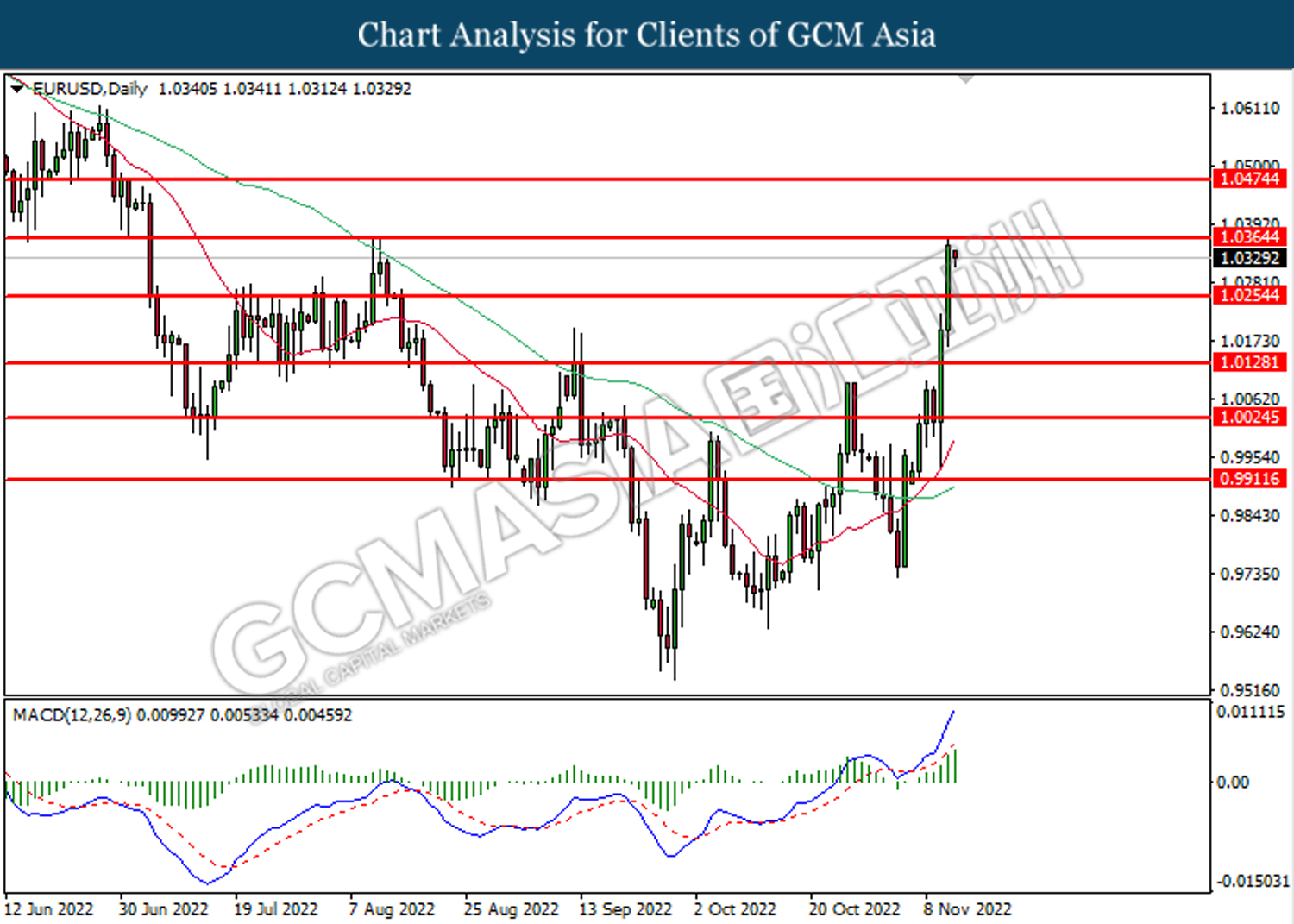

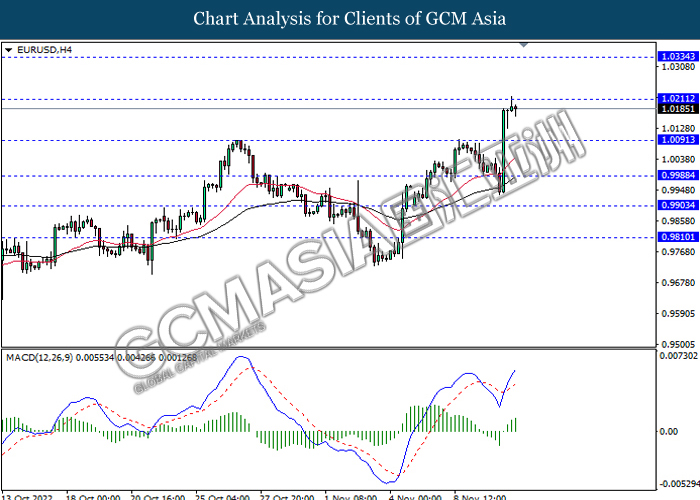

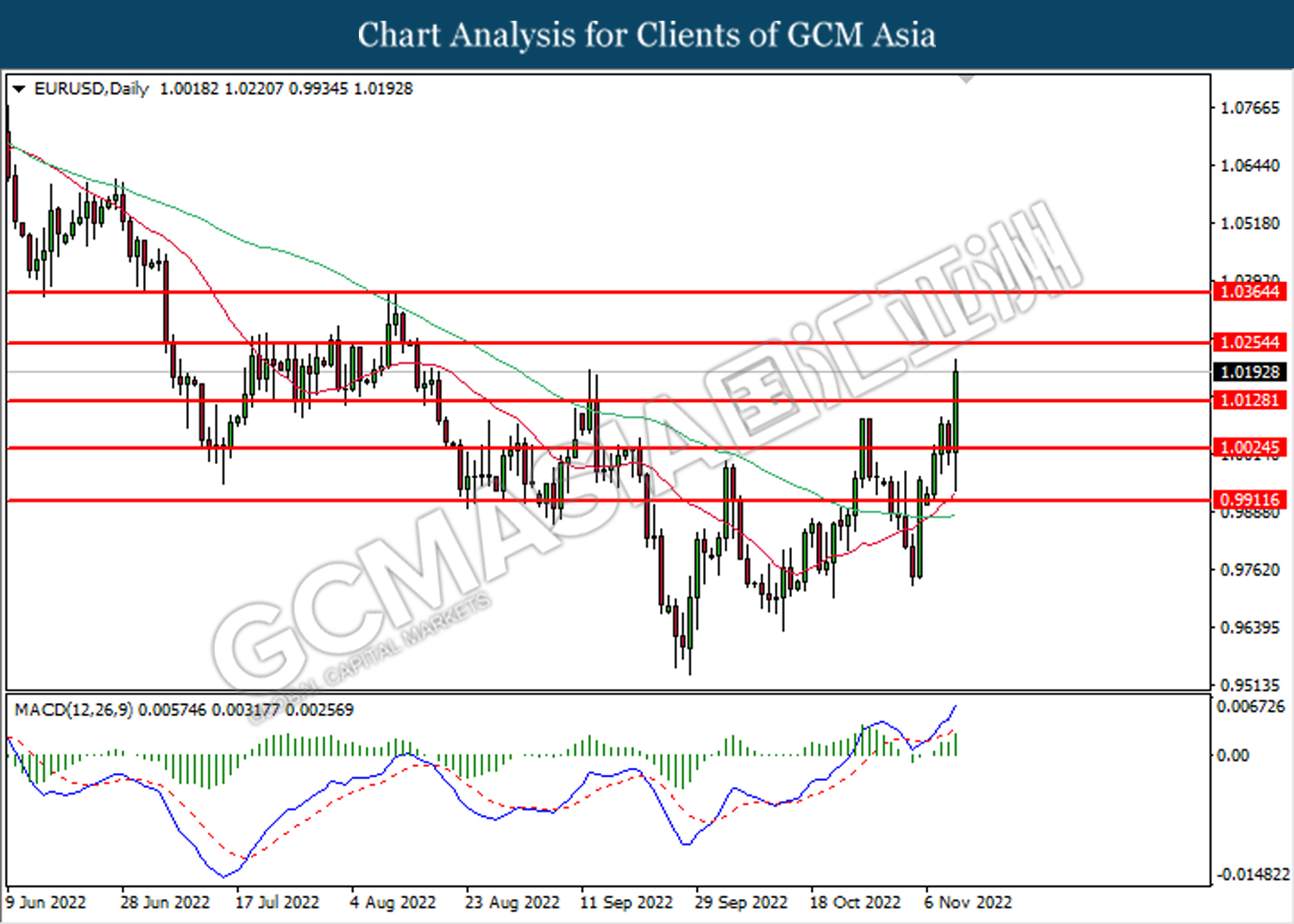

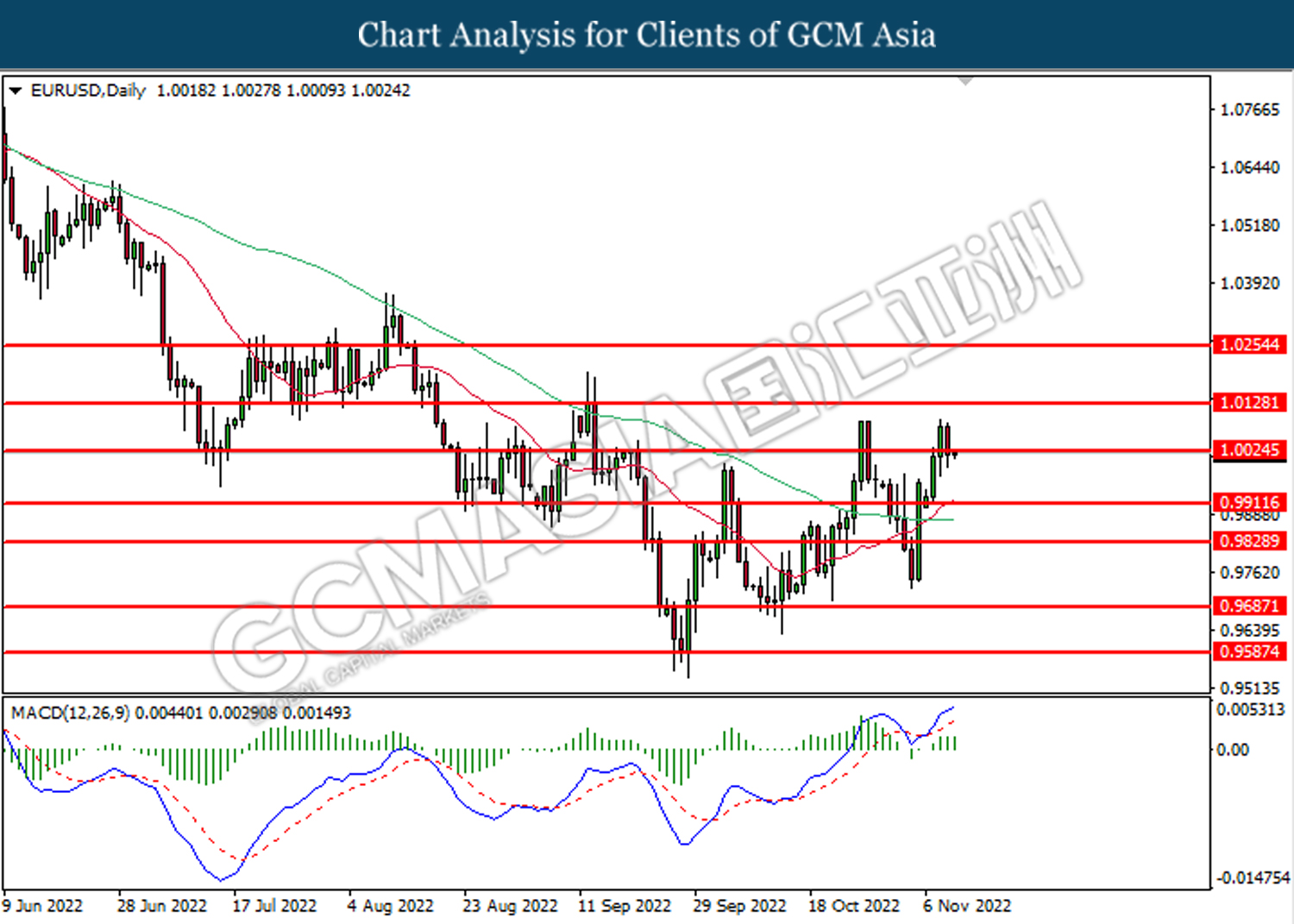

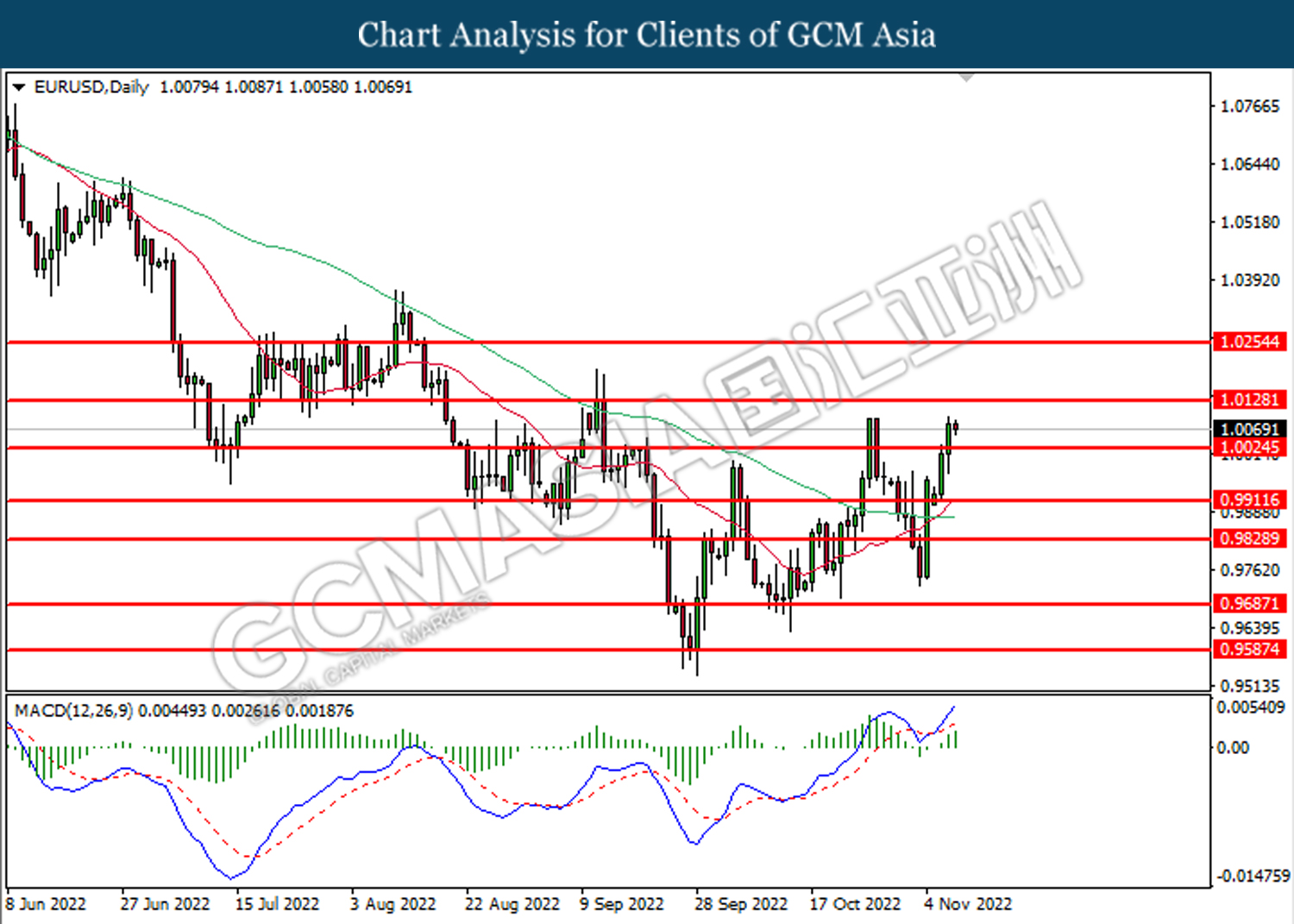

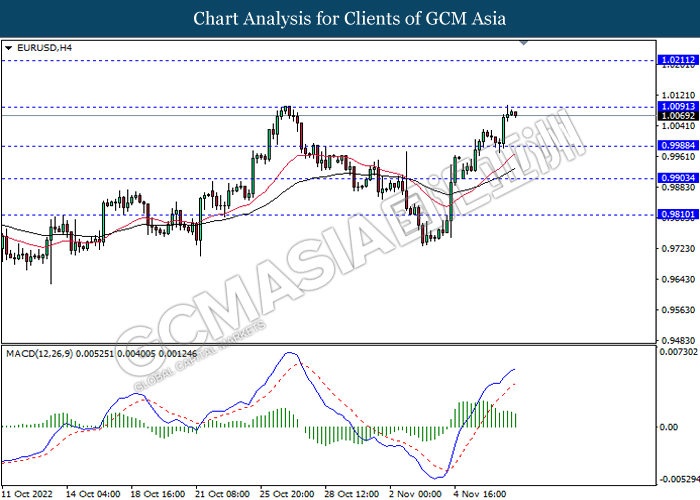

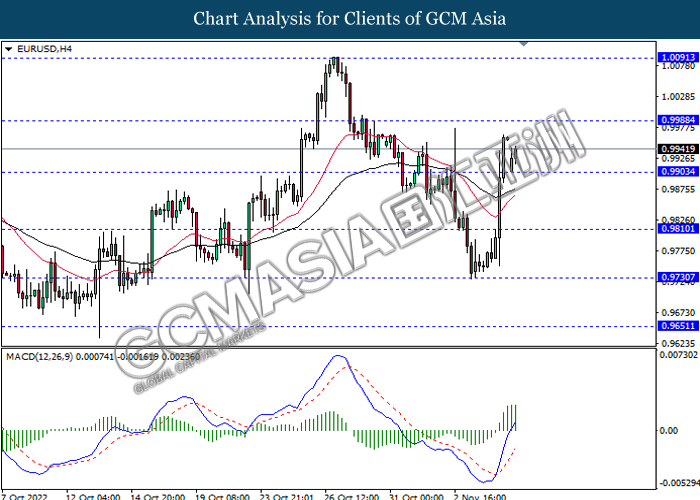

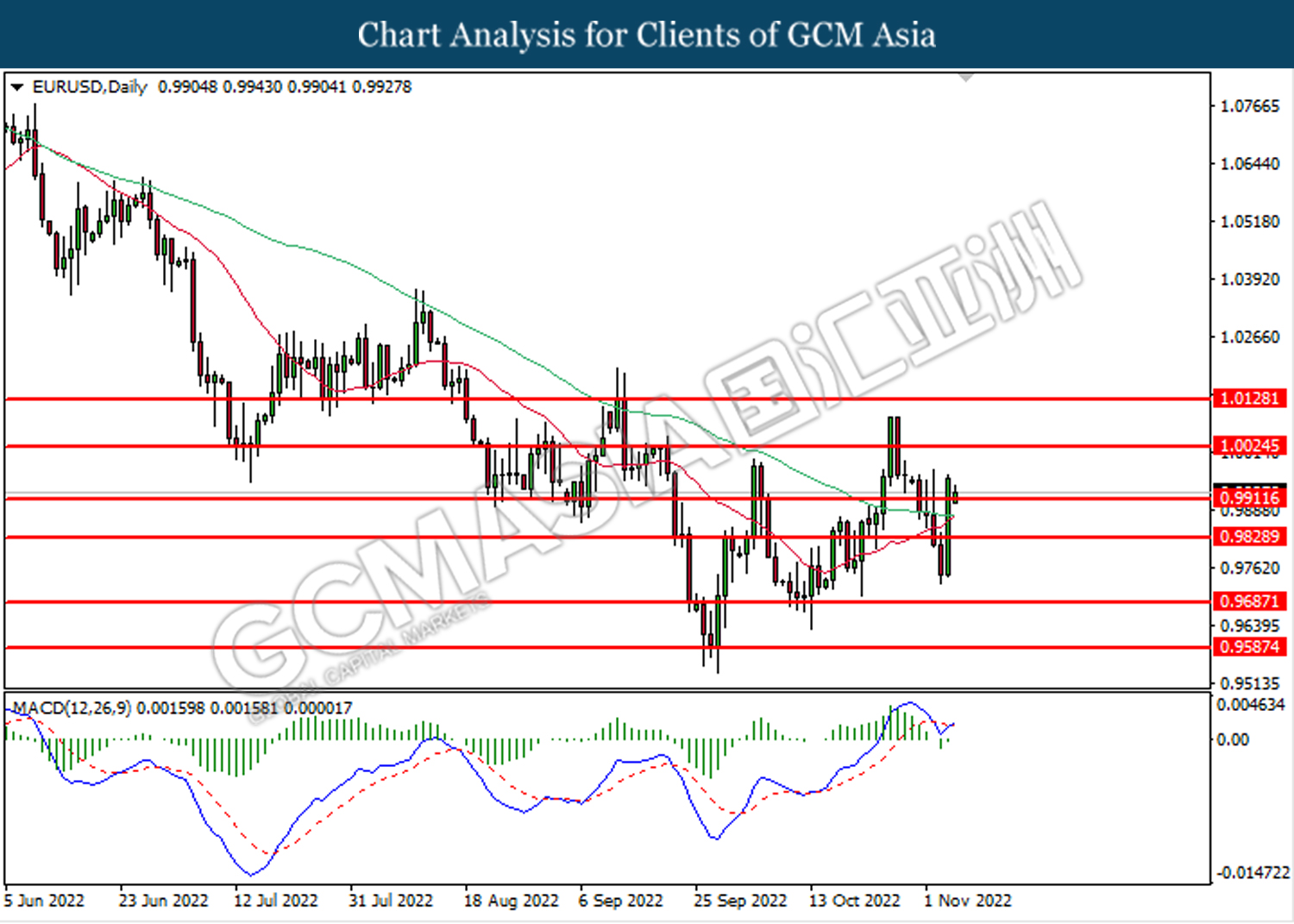

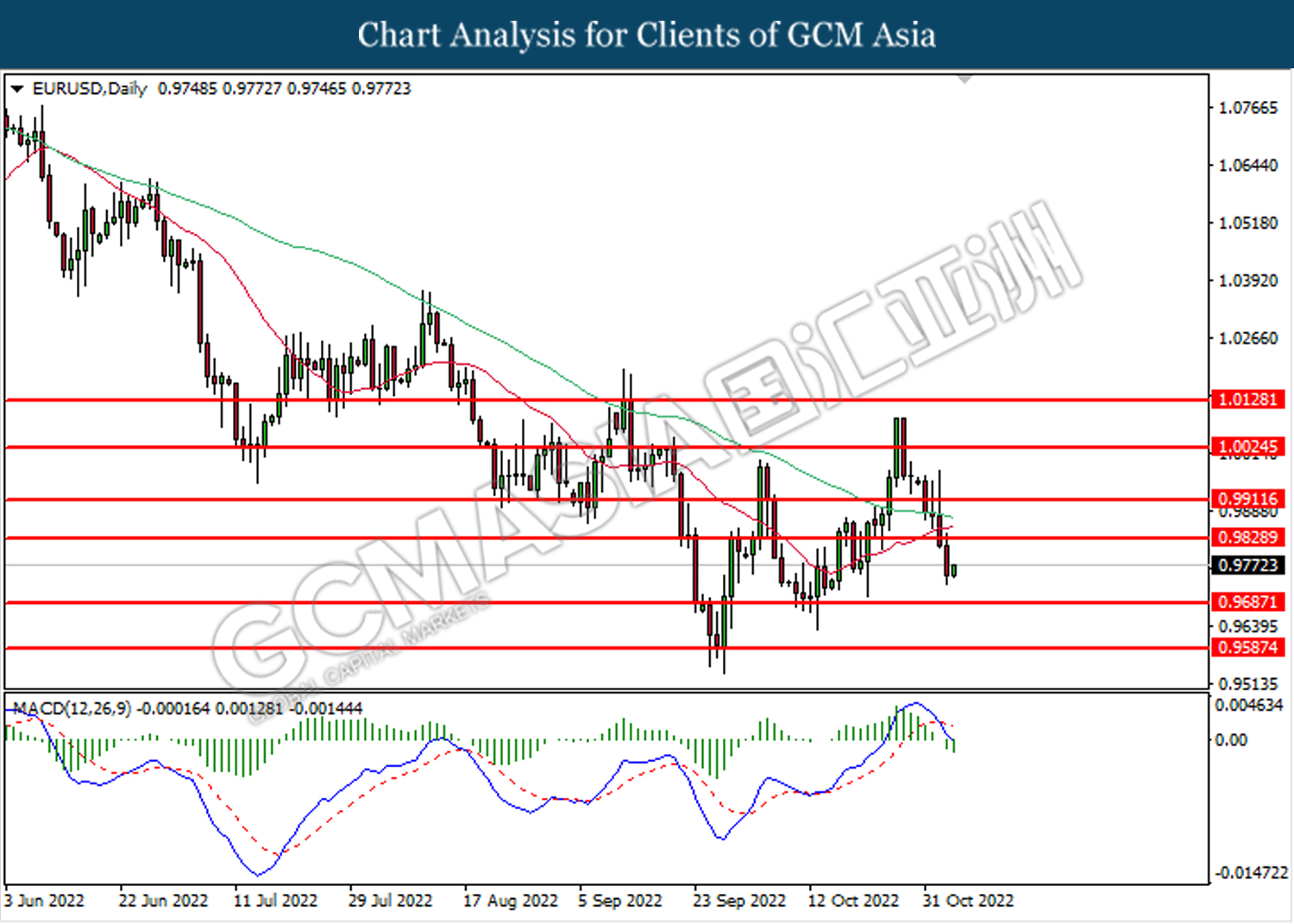

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

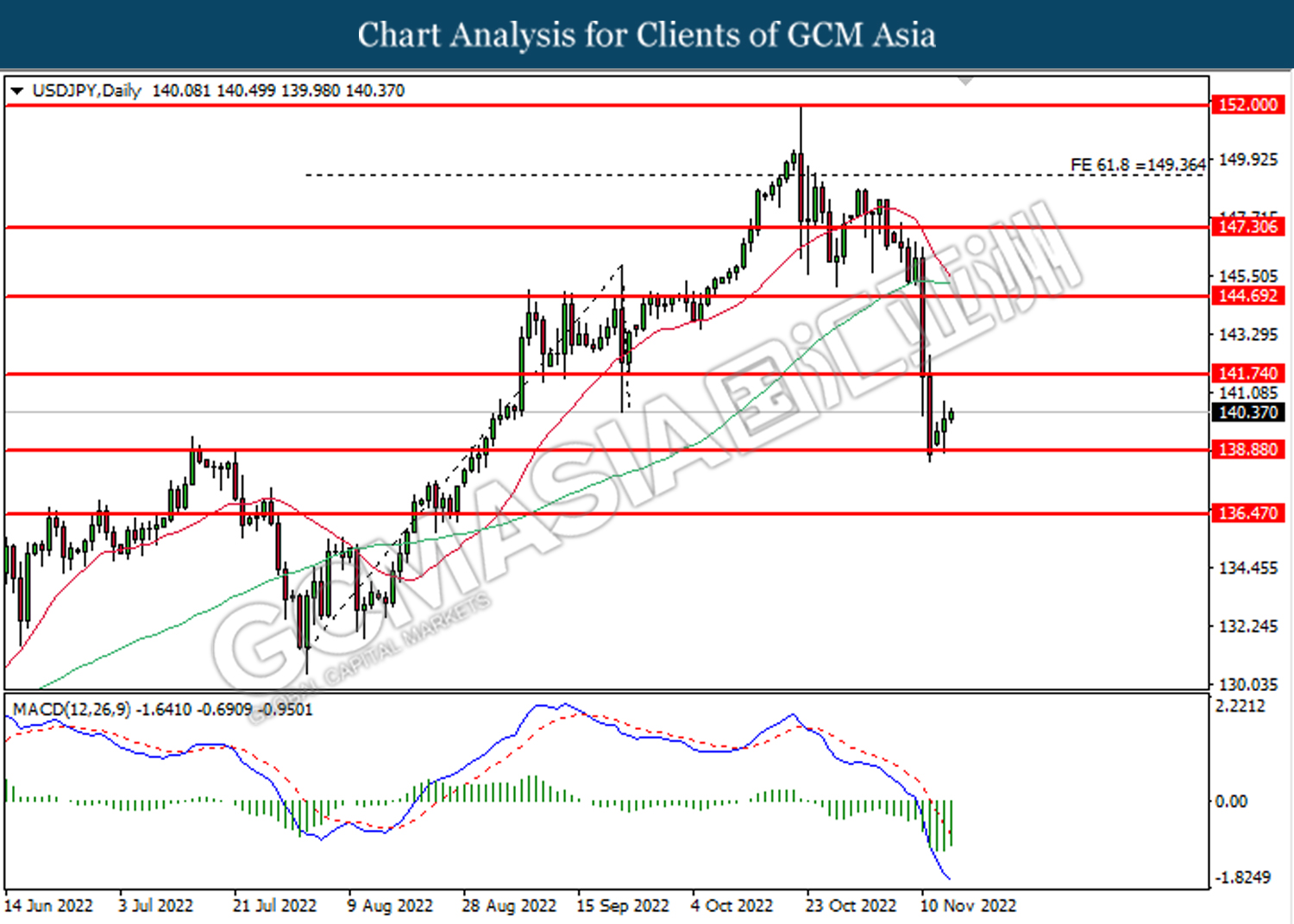

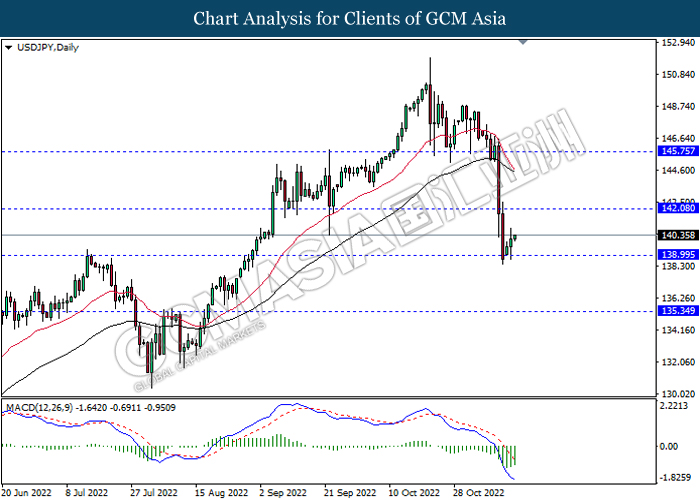

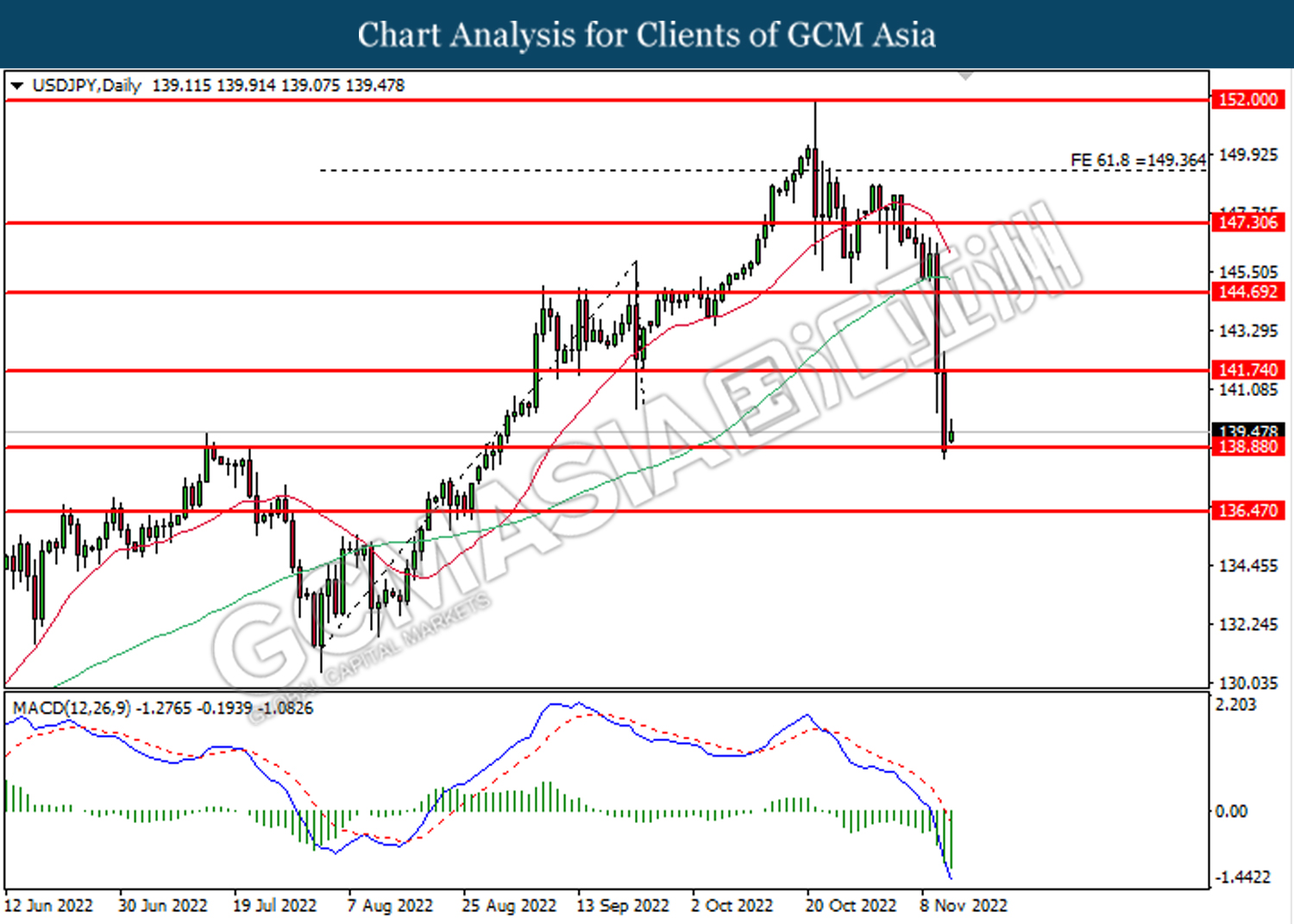

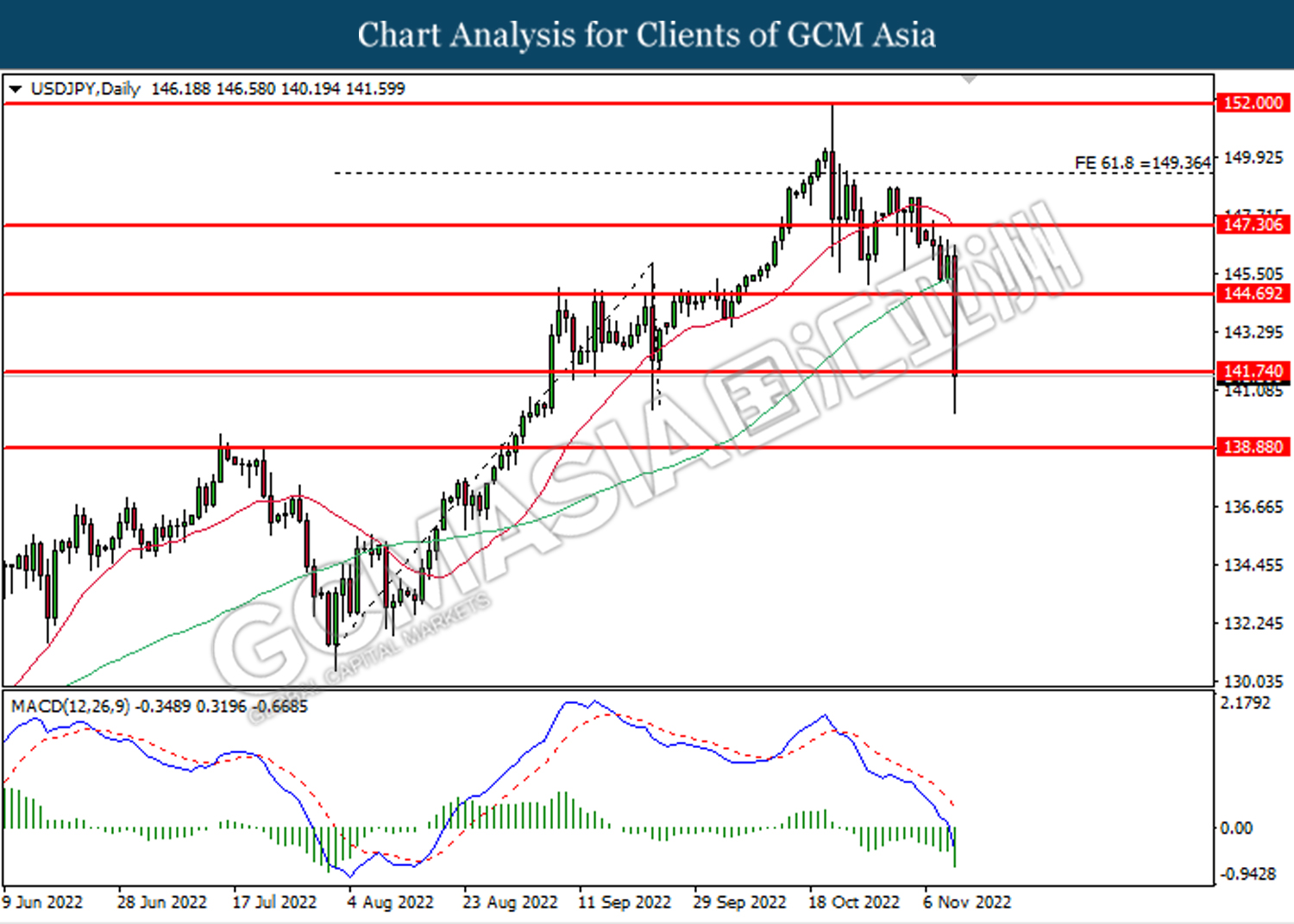

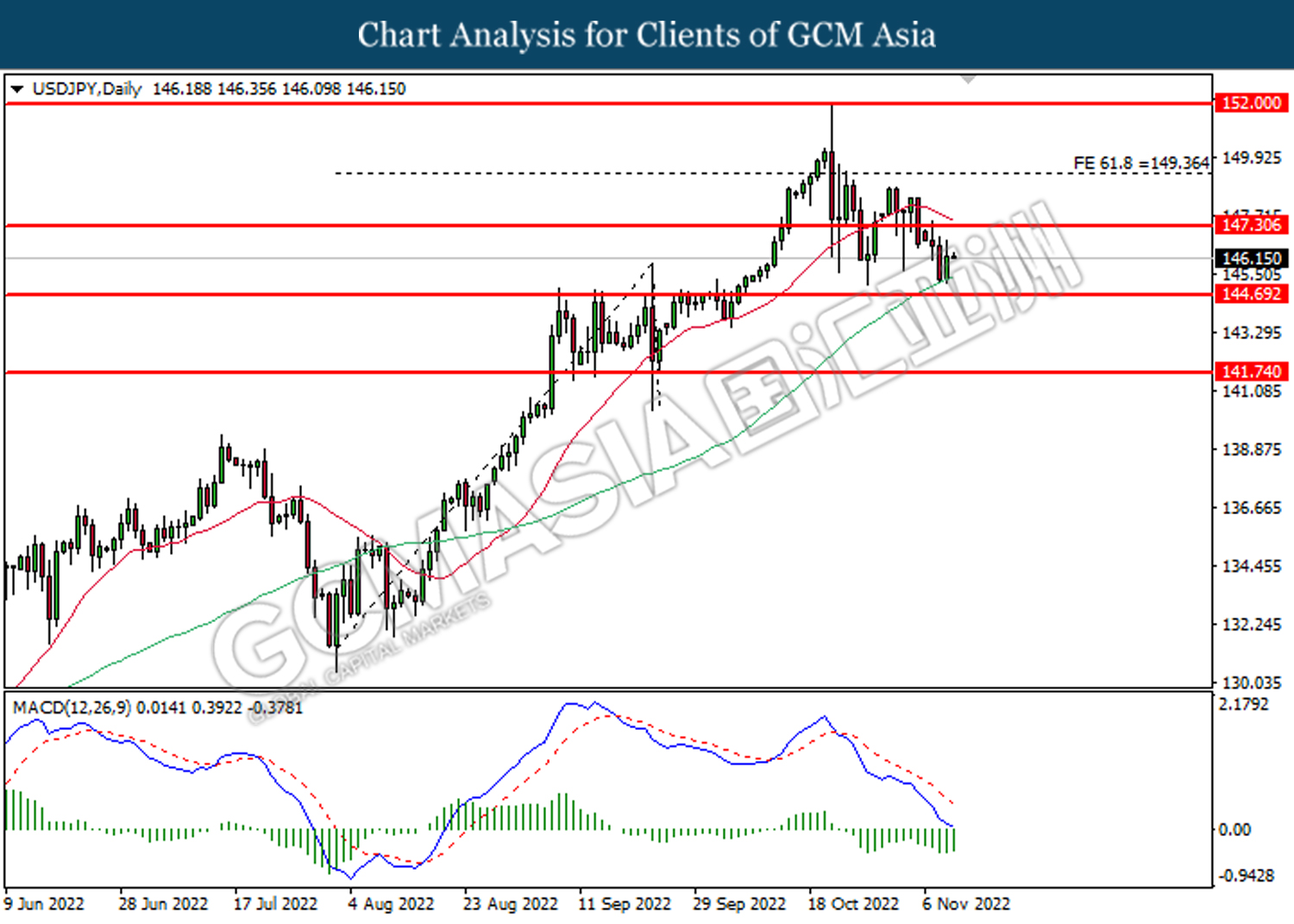

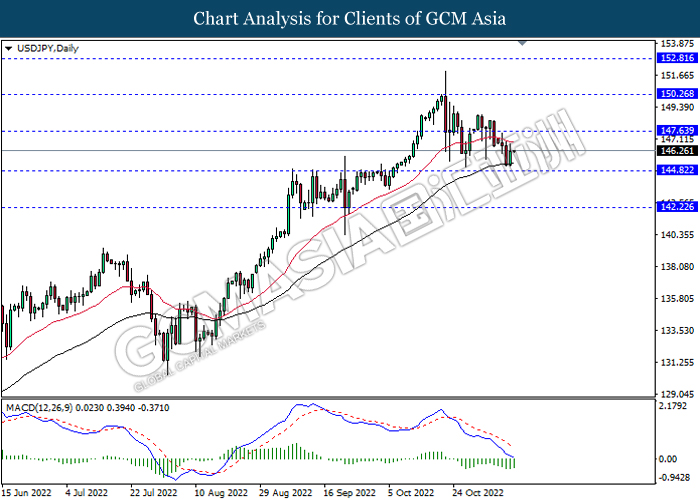

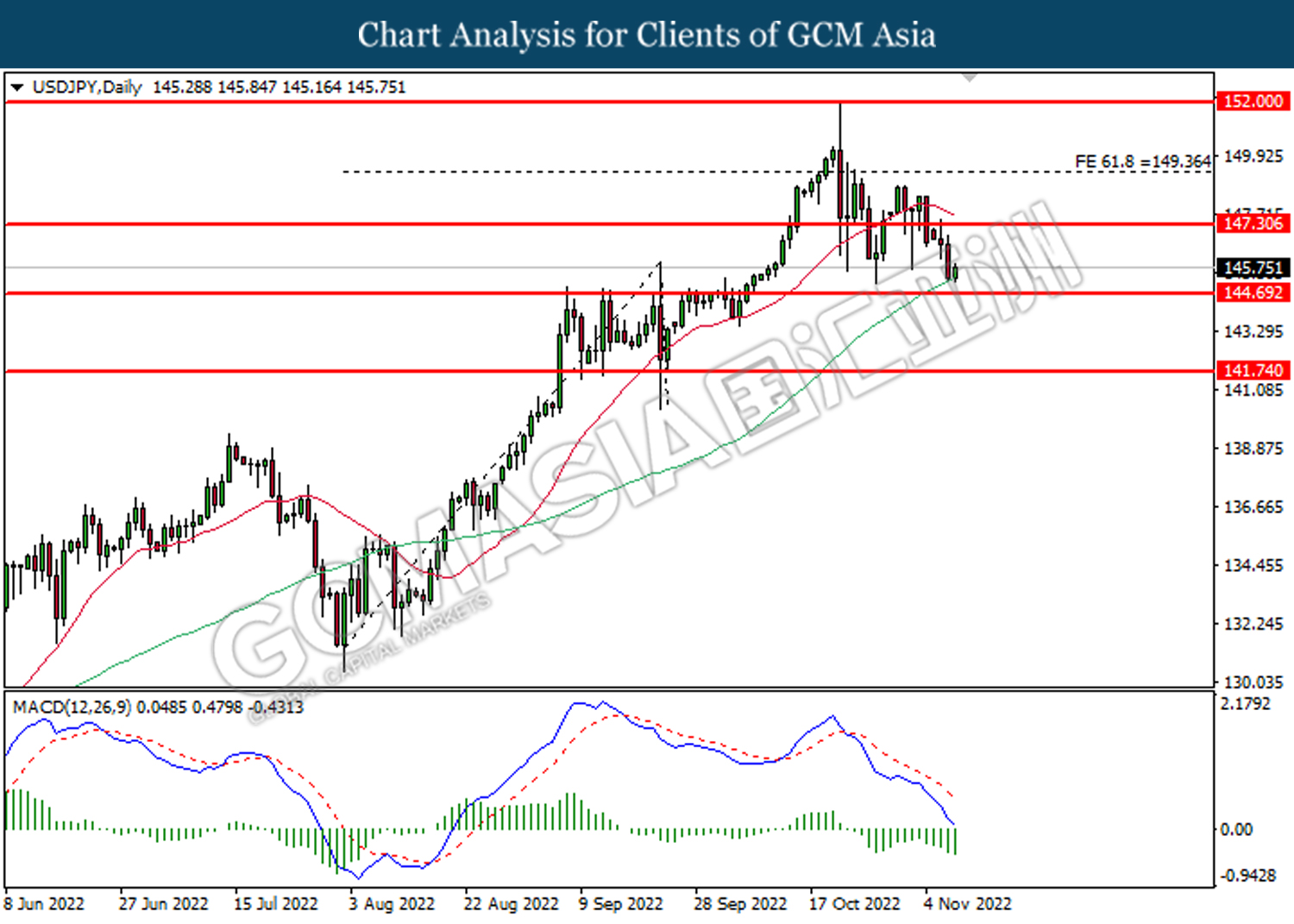

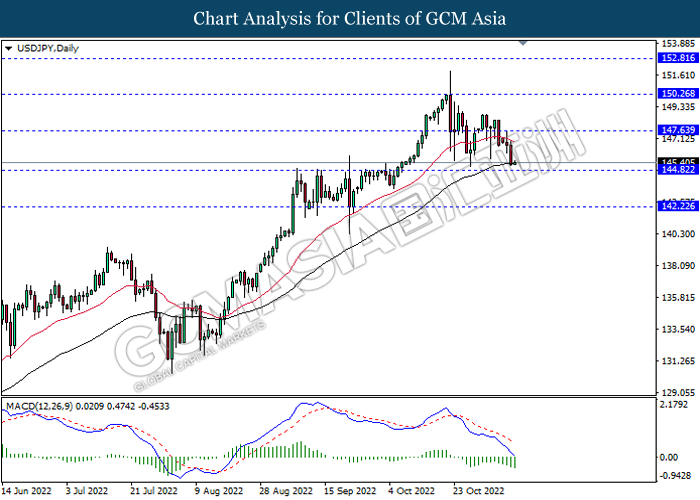

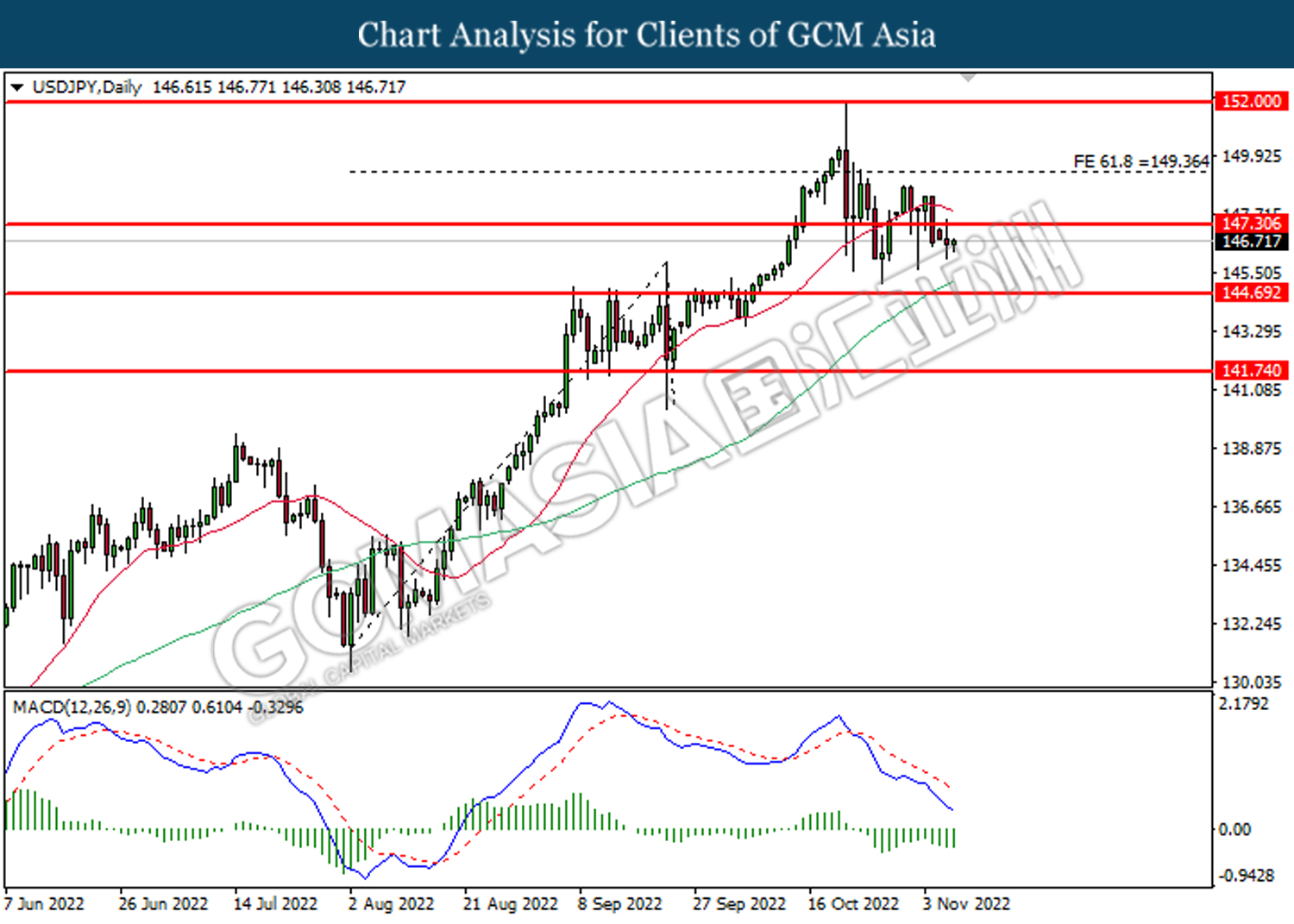

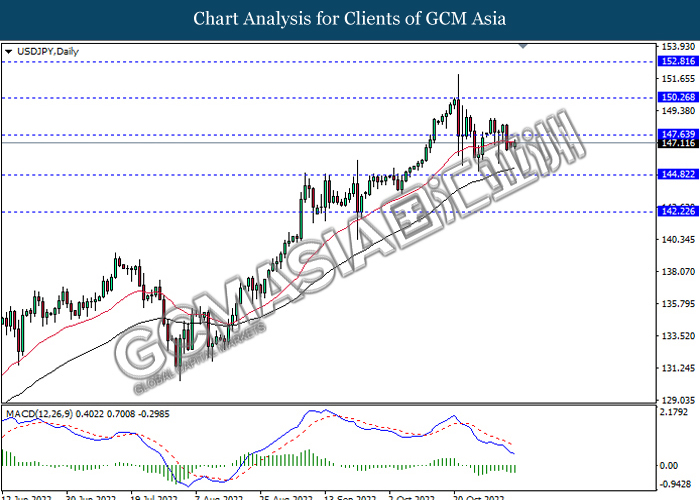

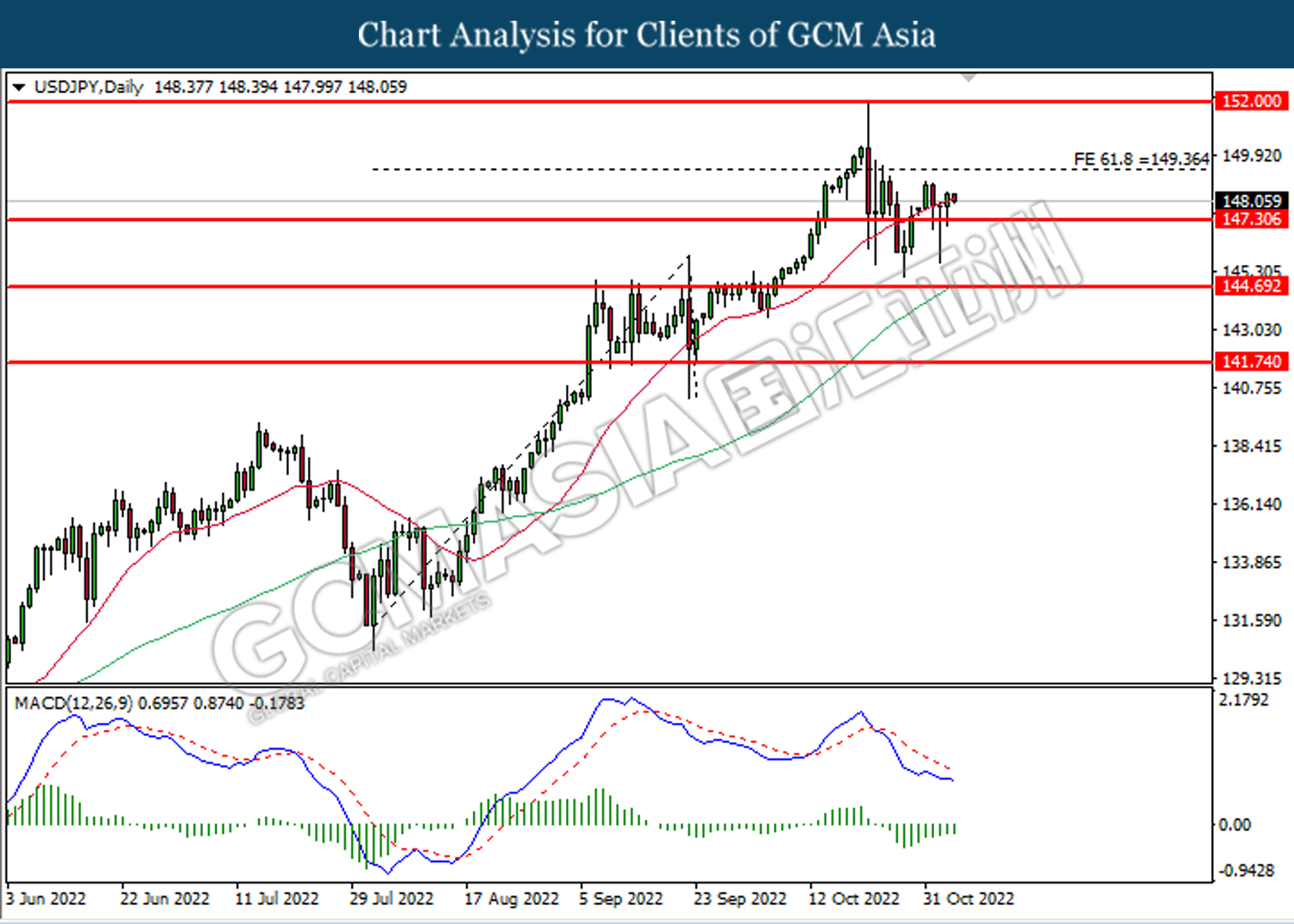

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.75.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

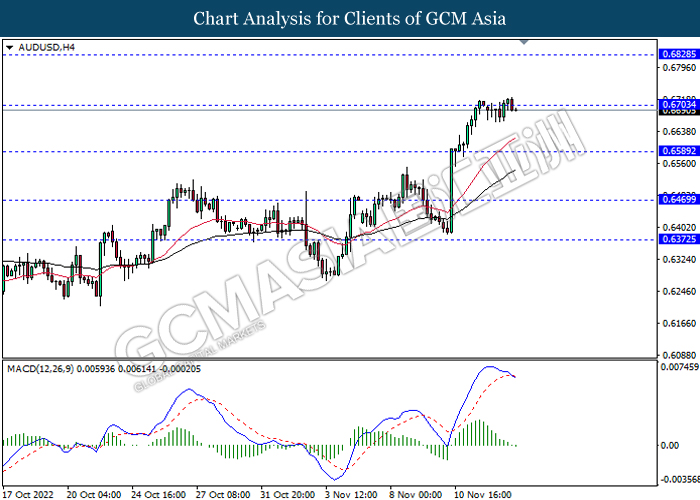

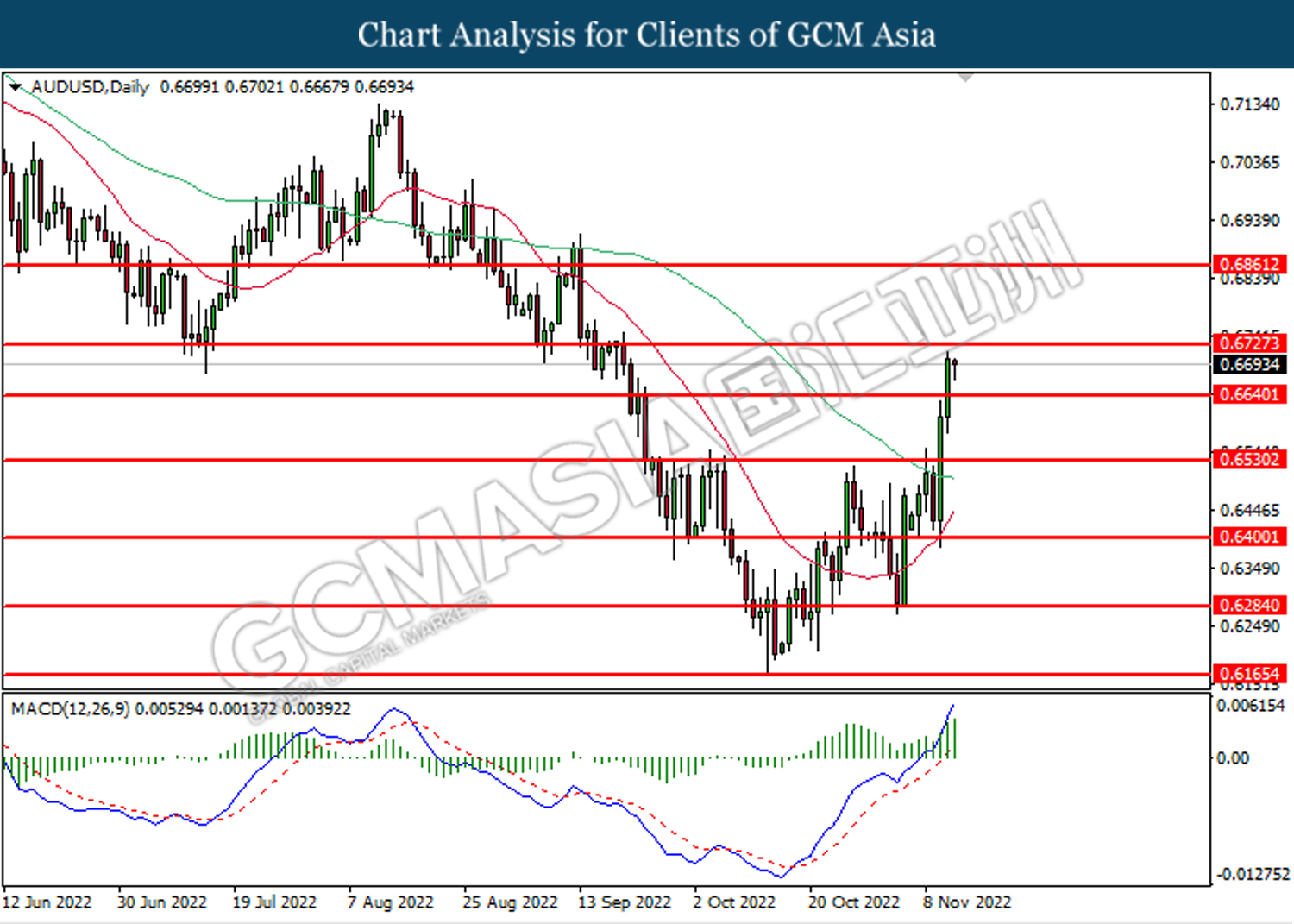

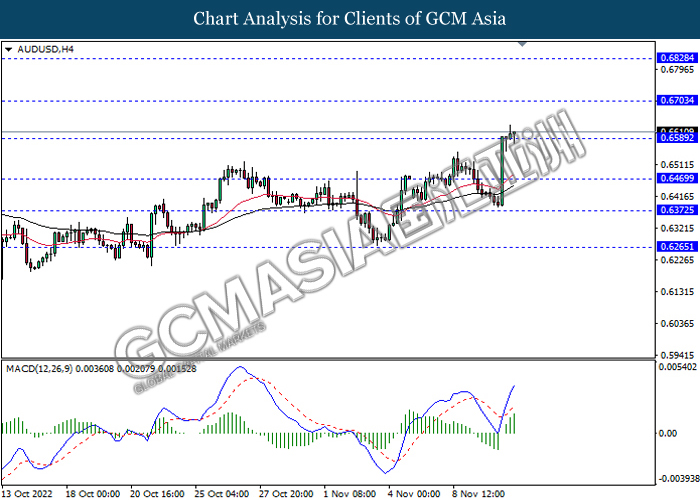

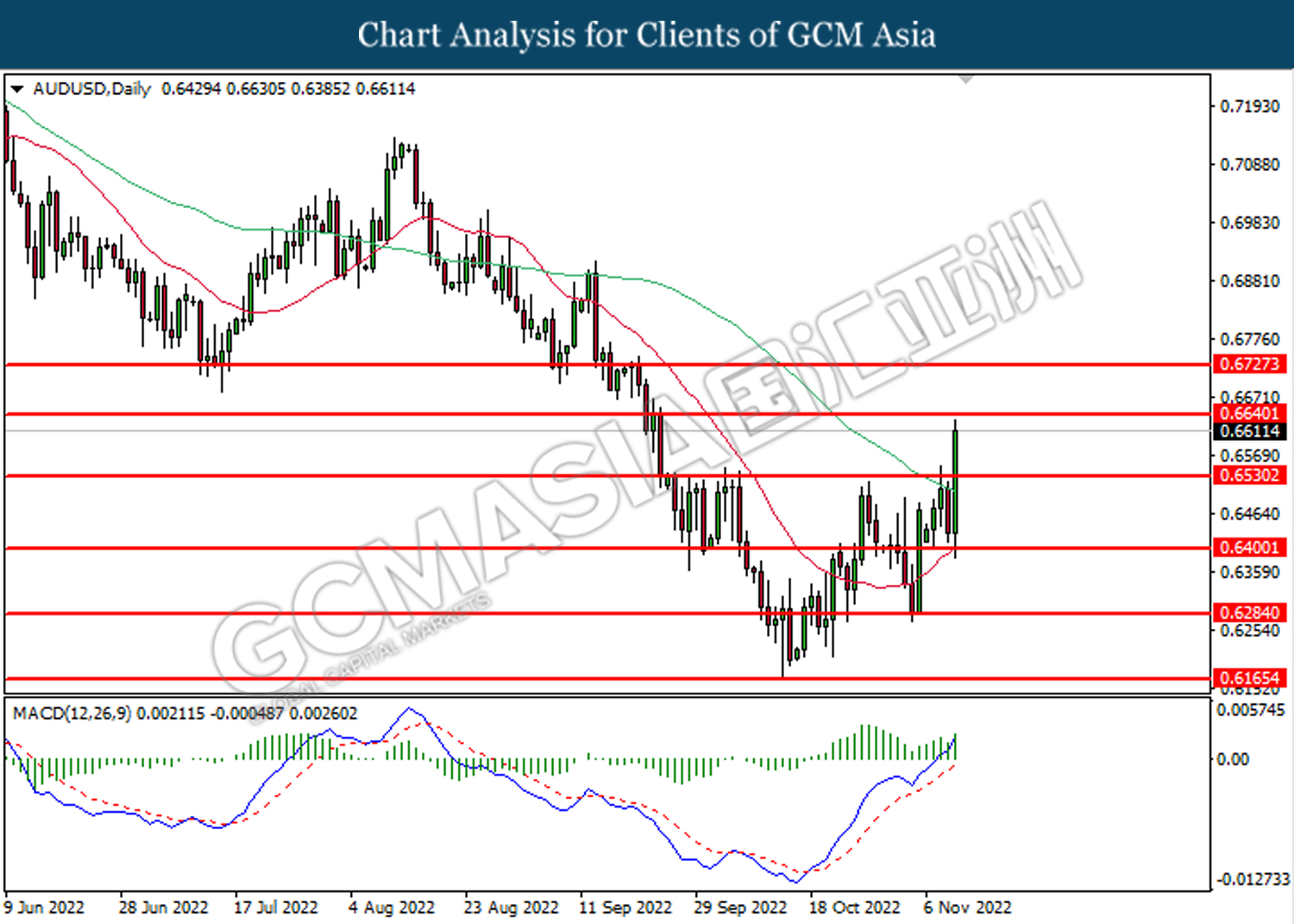

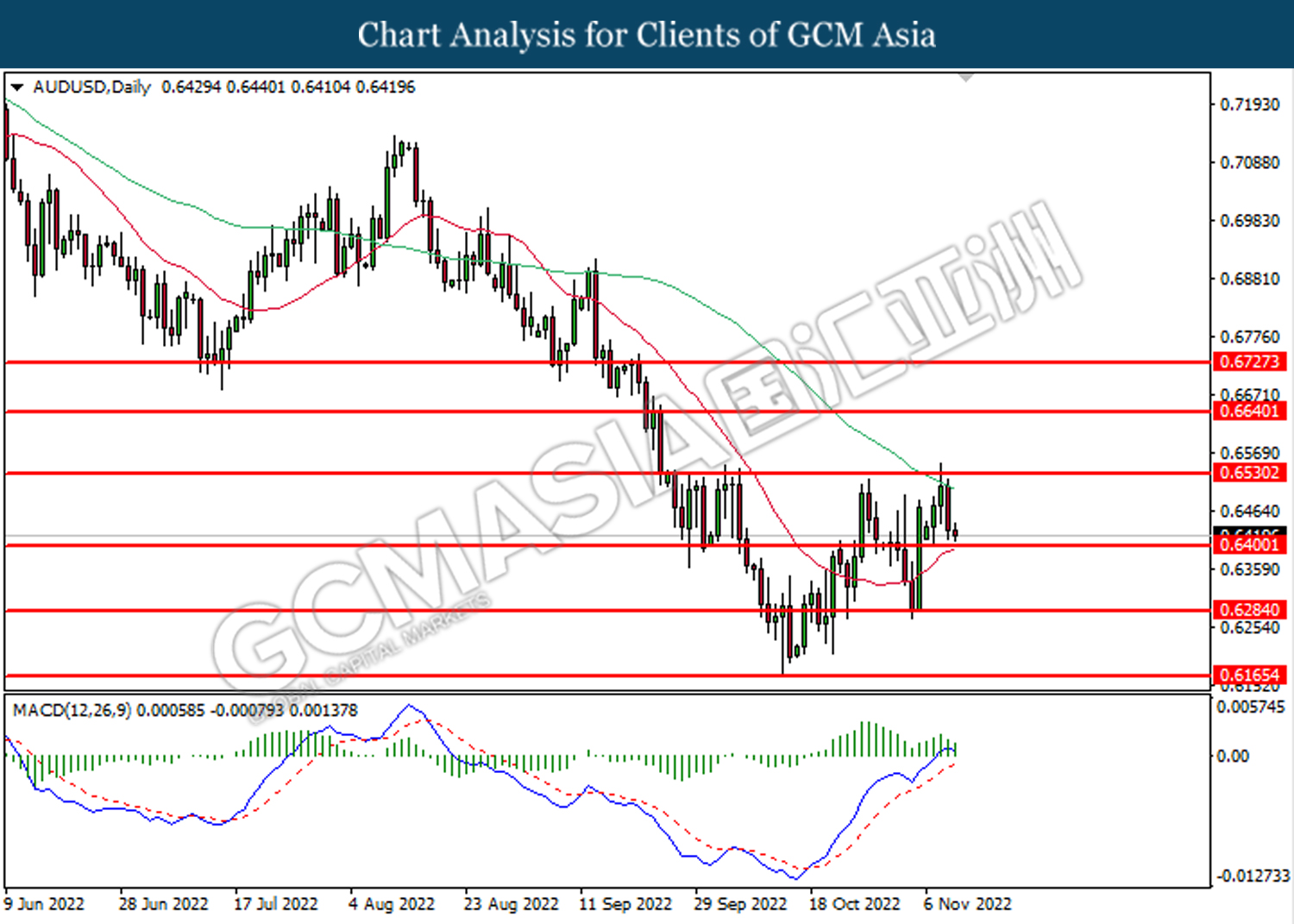

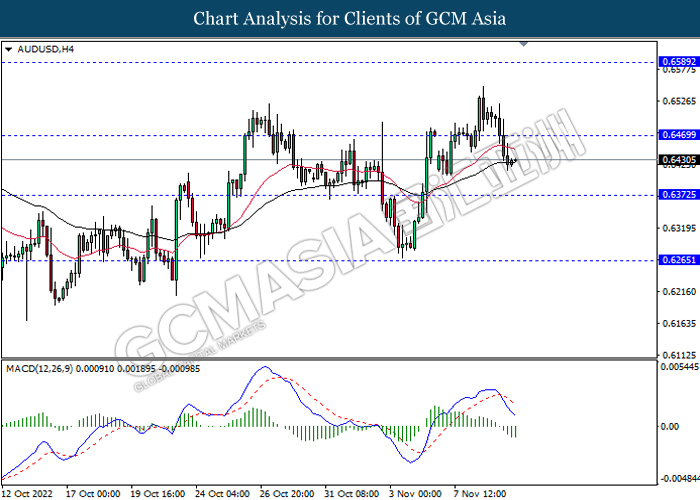

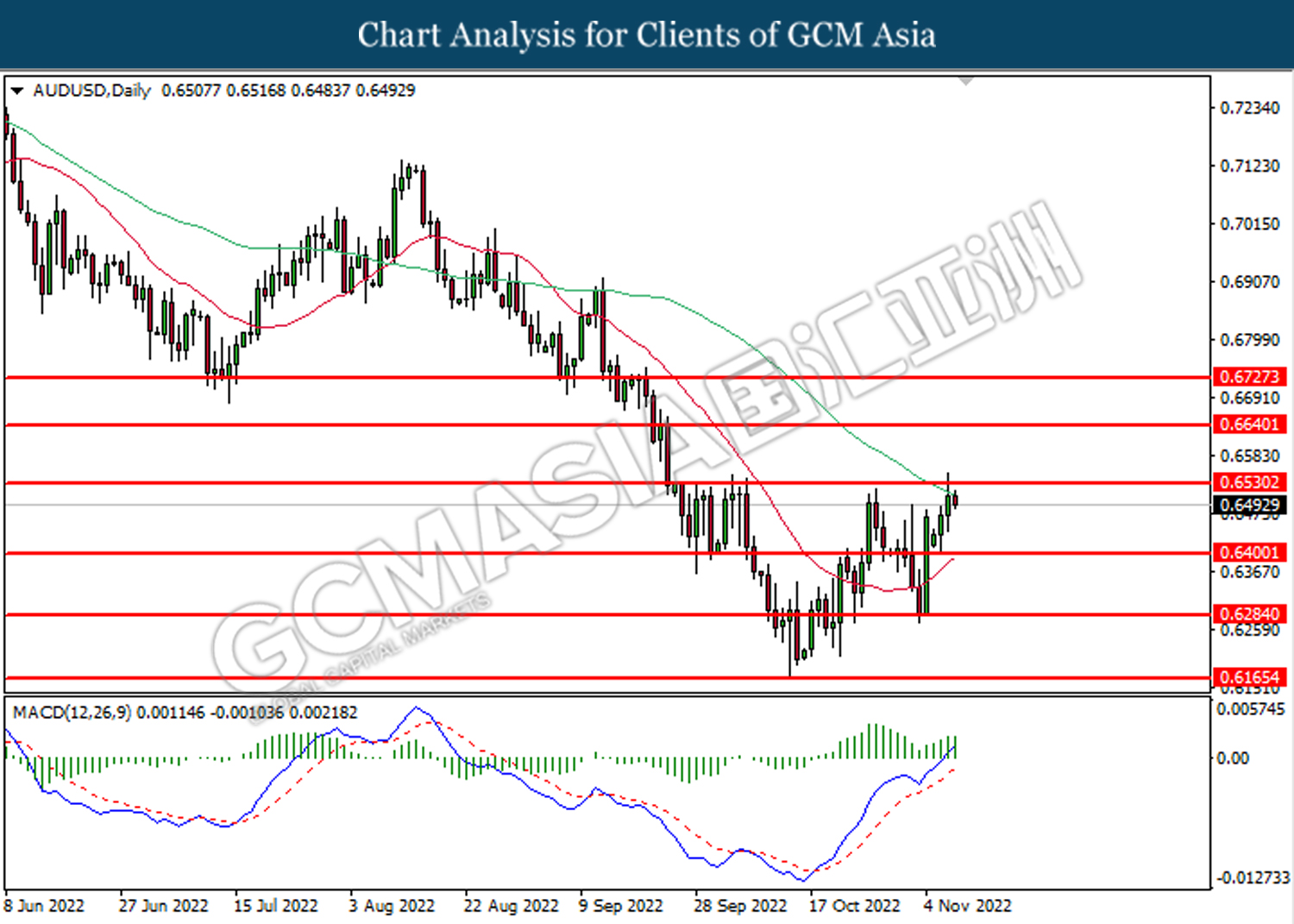

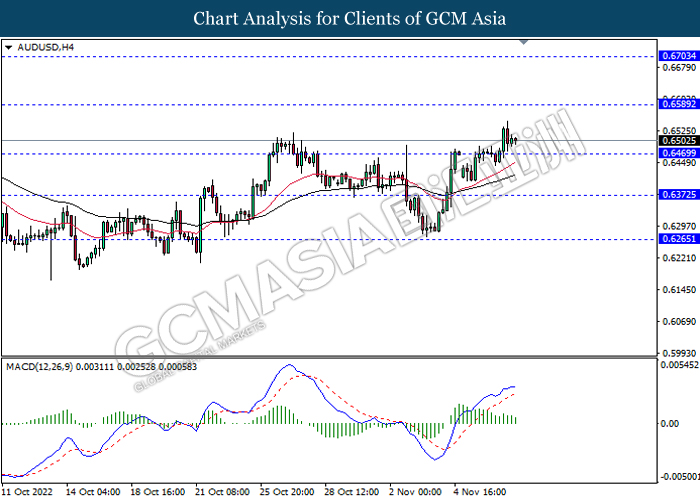

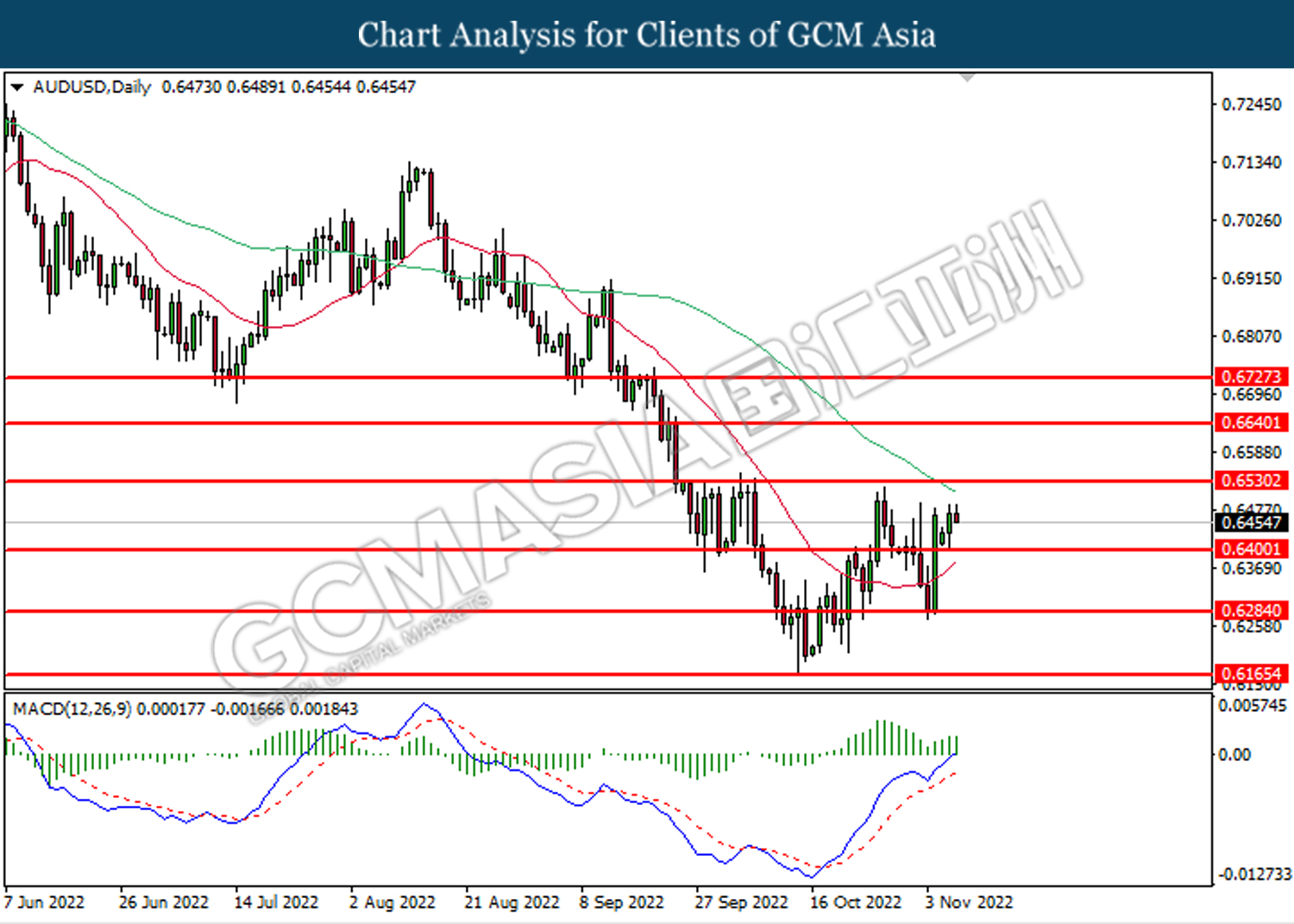

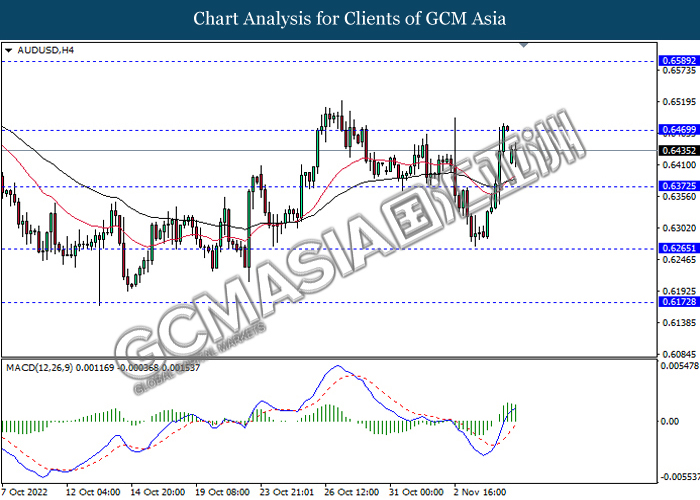

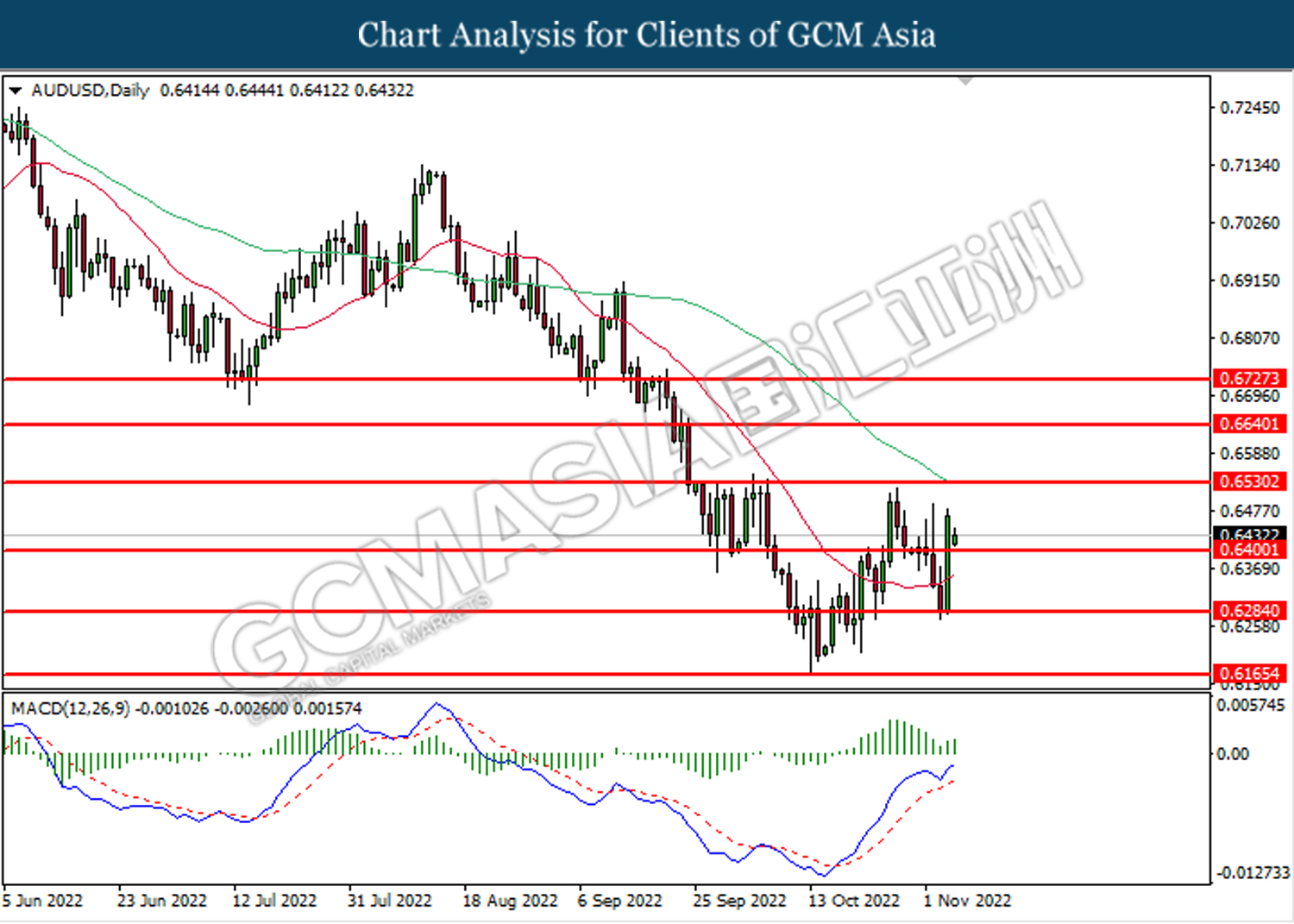

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6640. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6725.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

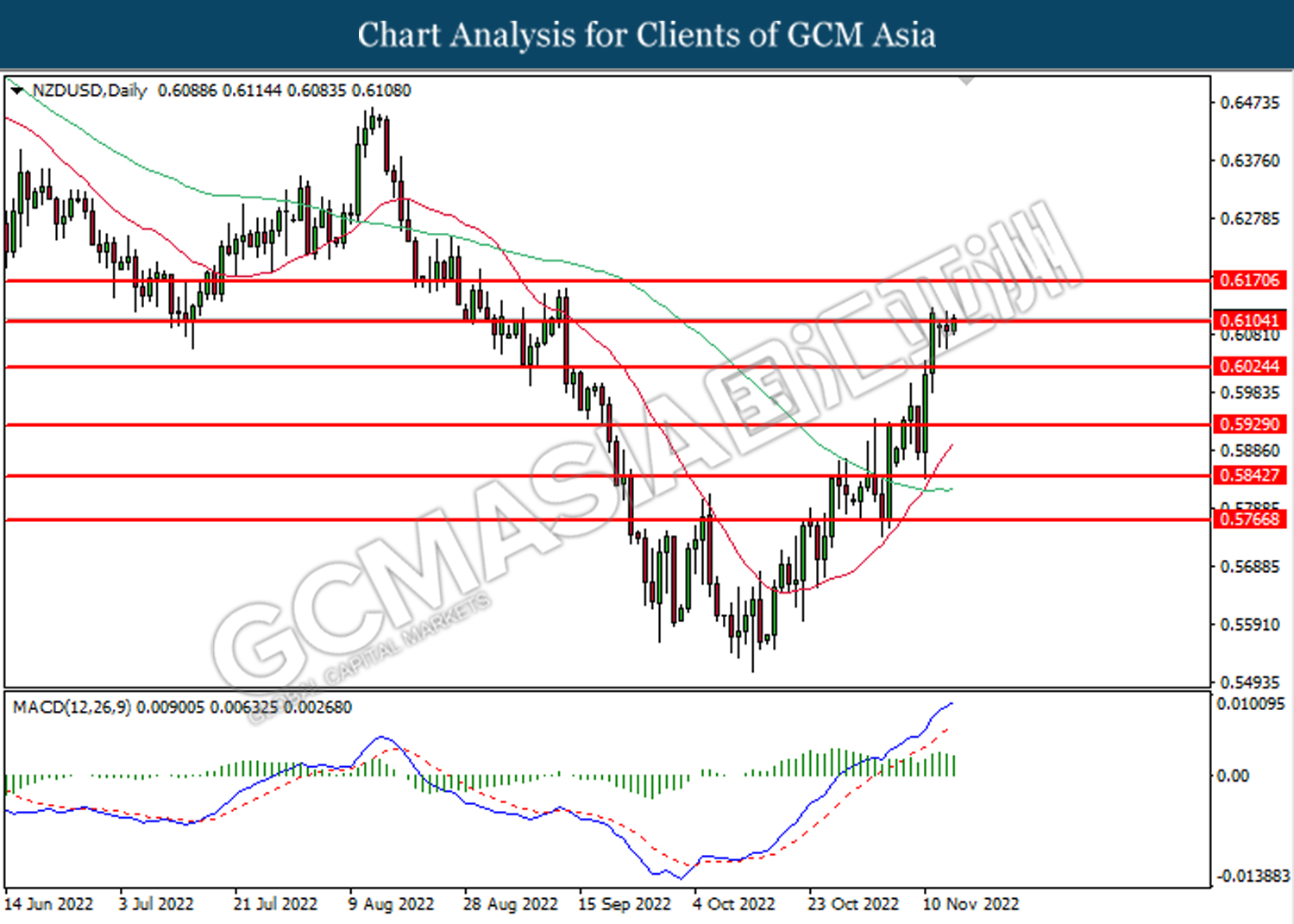

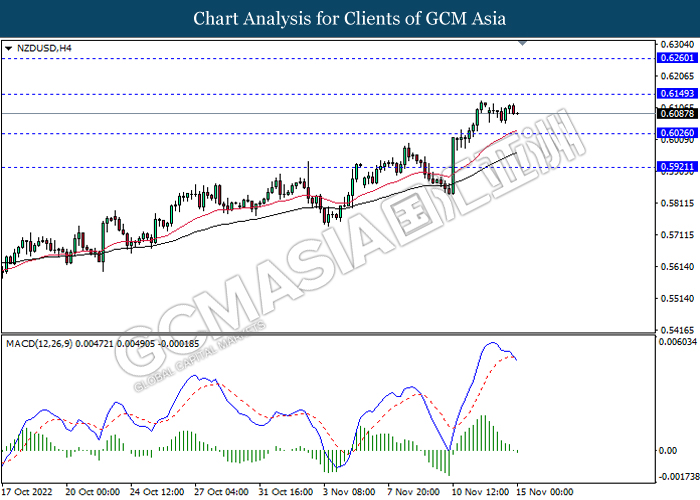

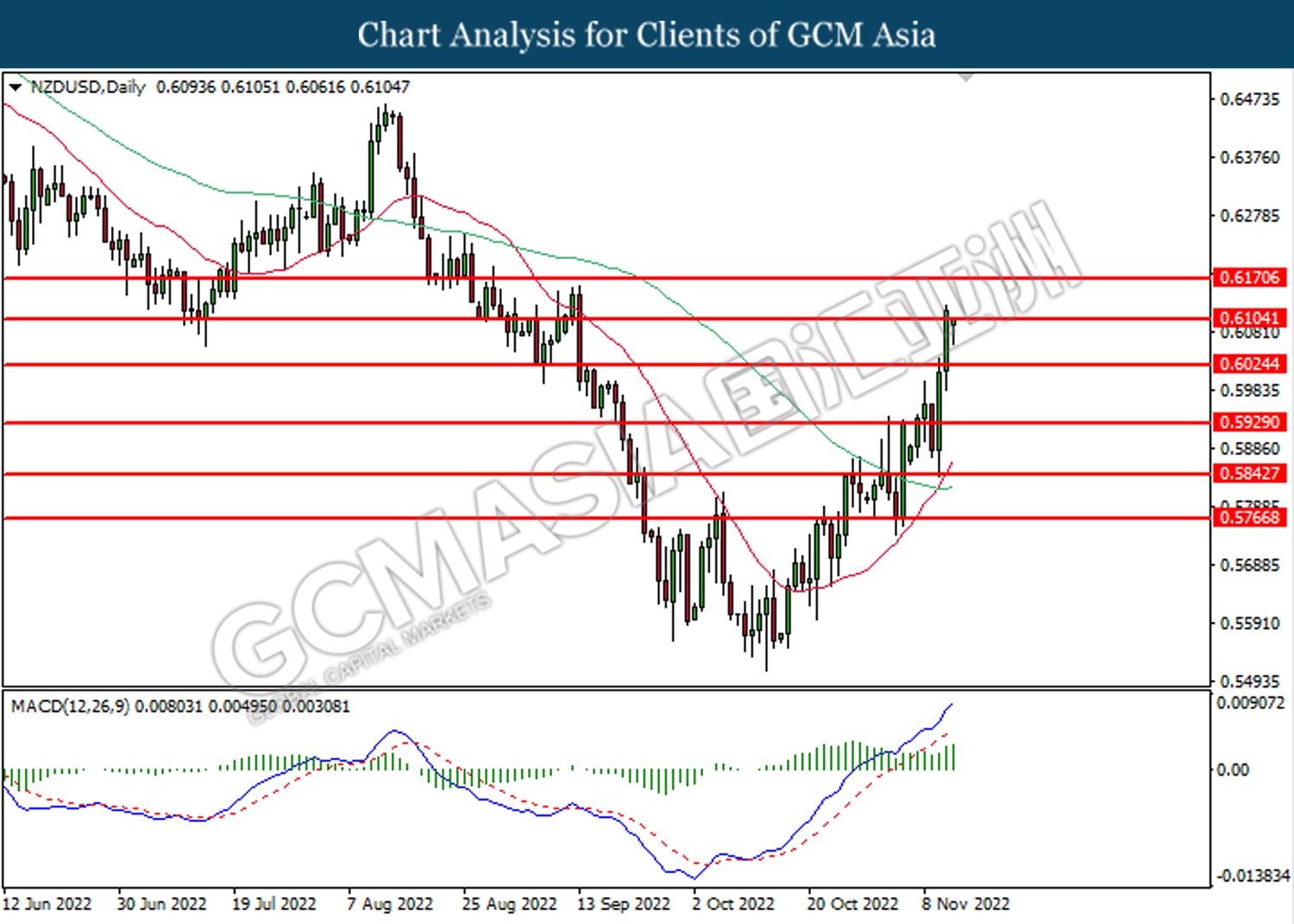

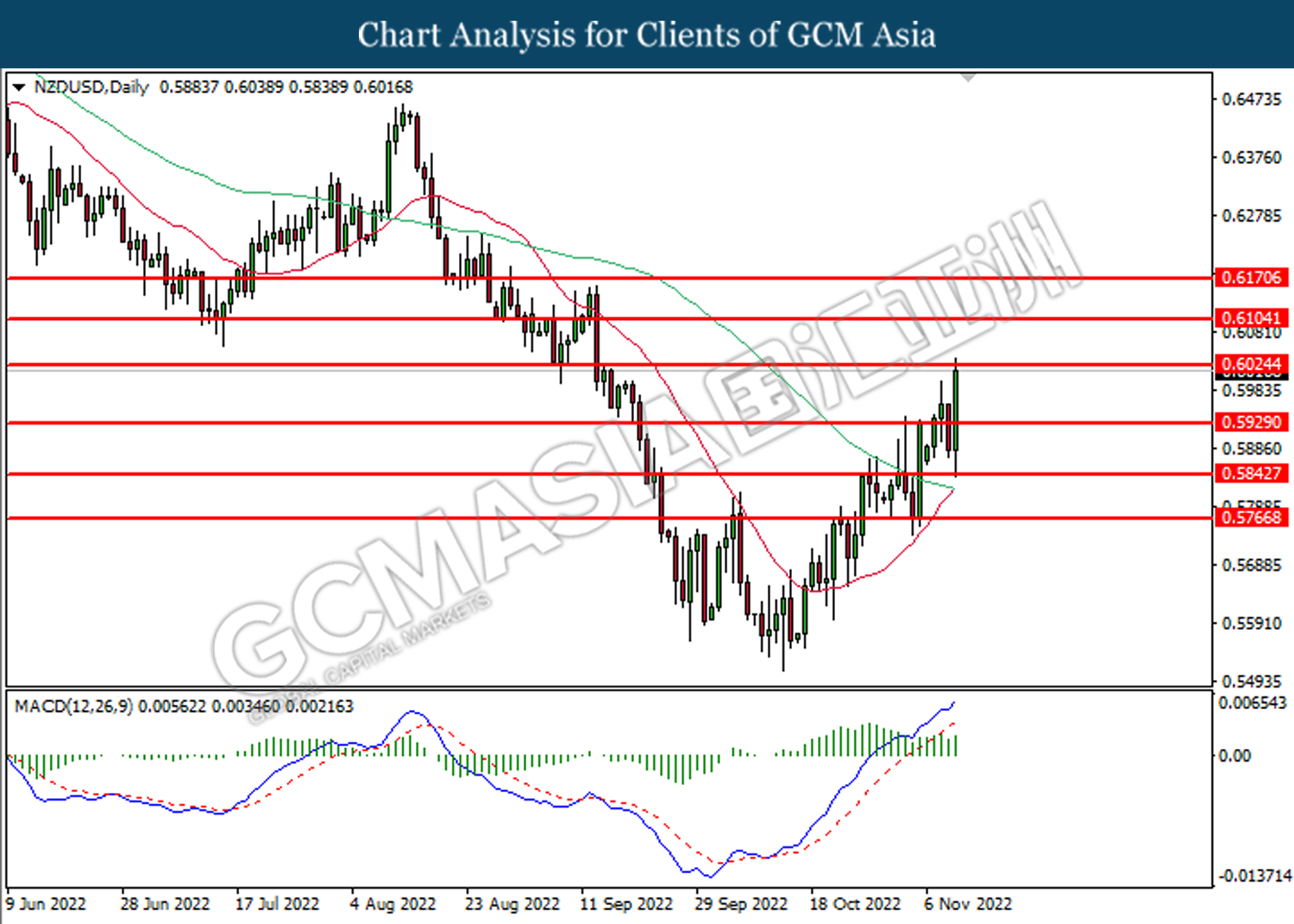

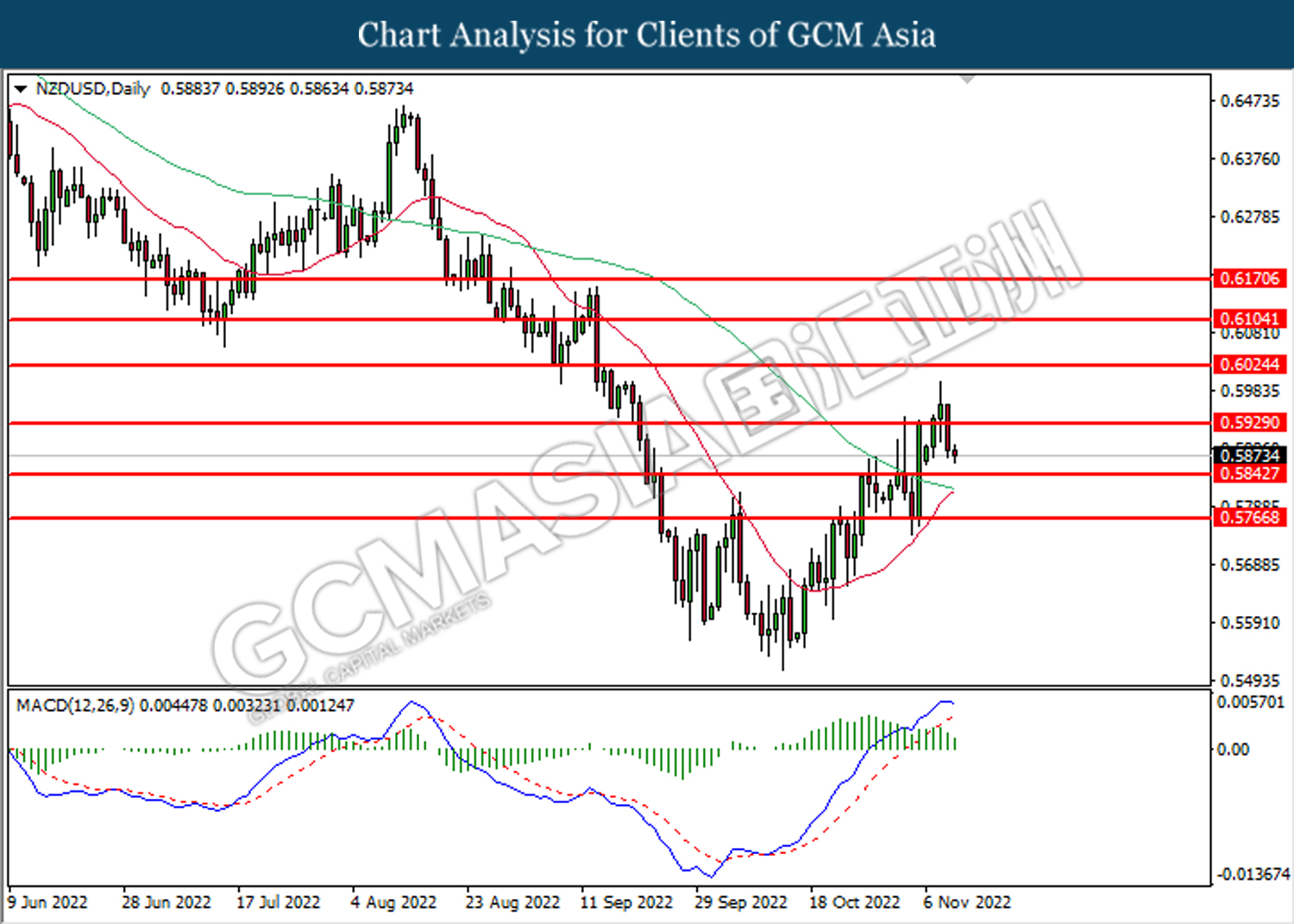

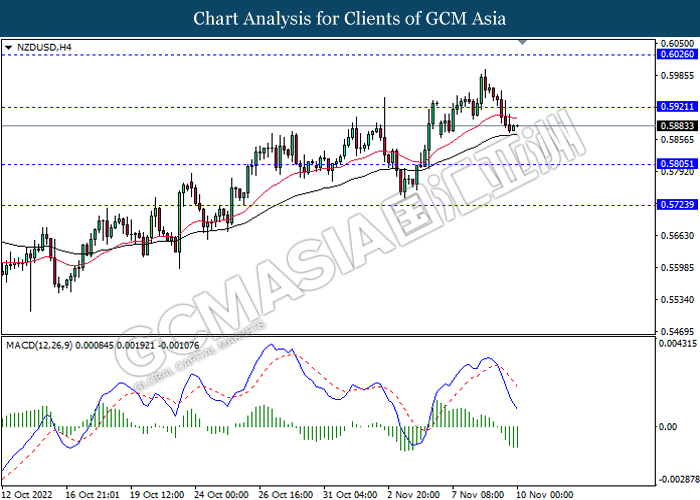

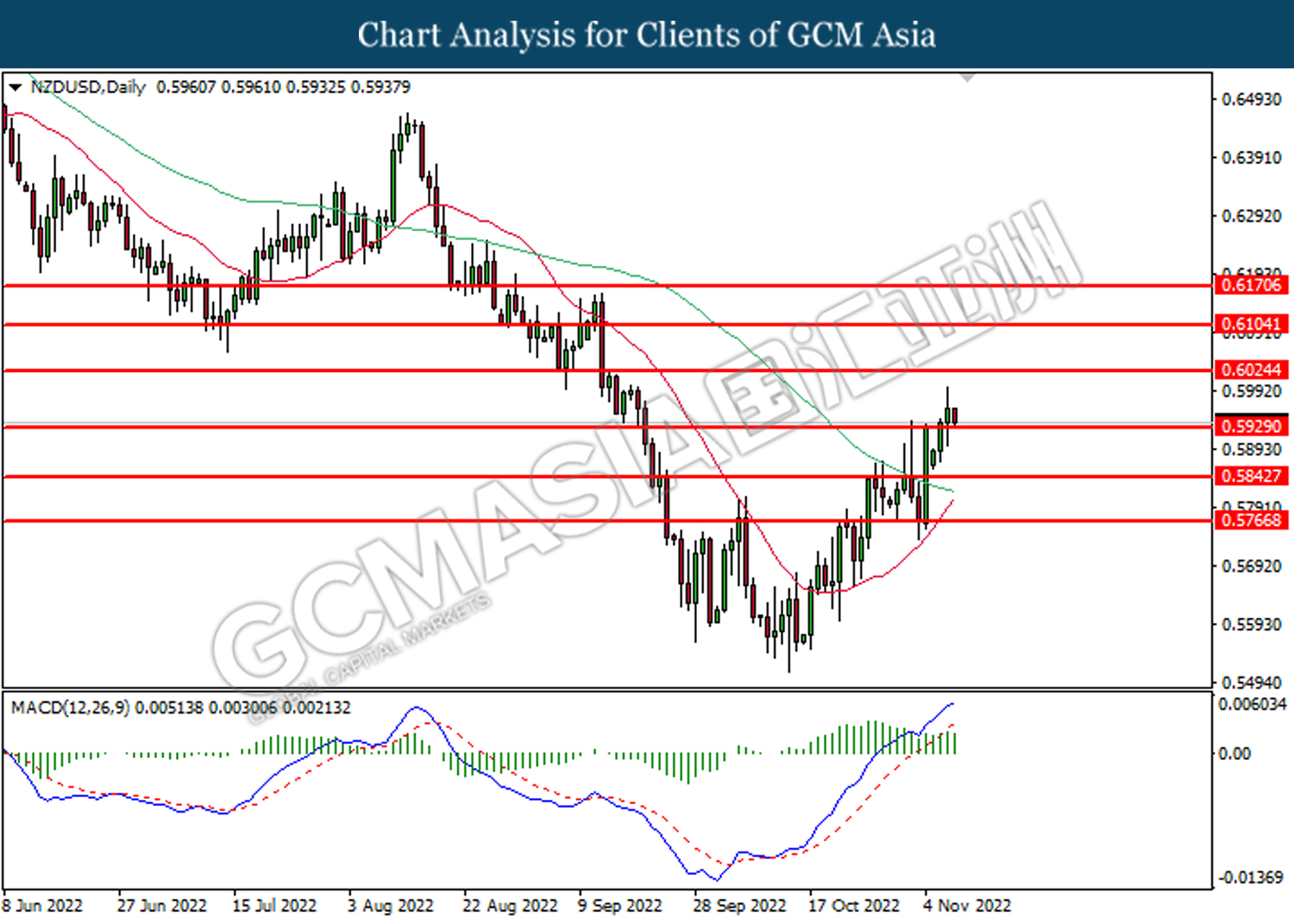

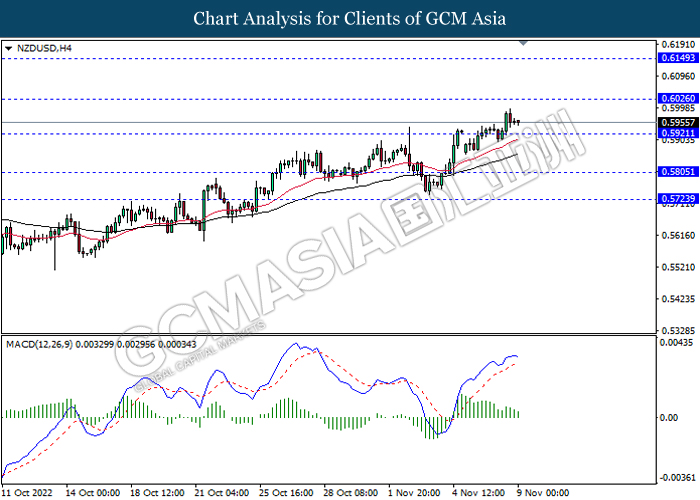

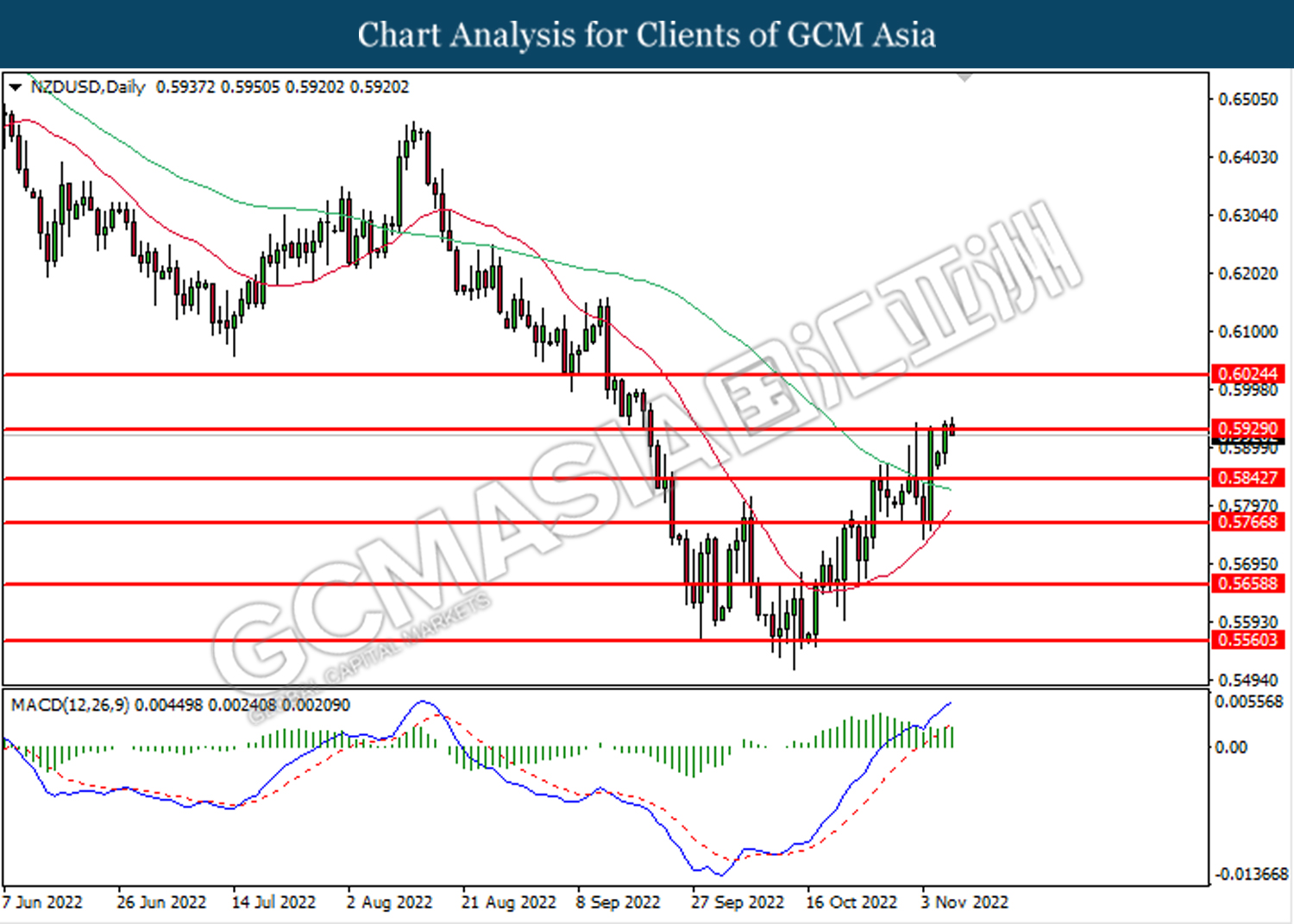

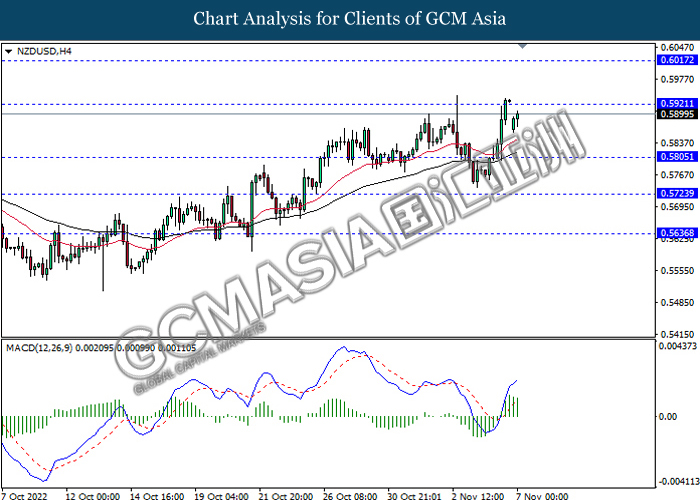

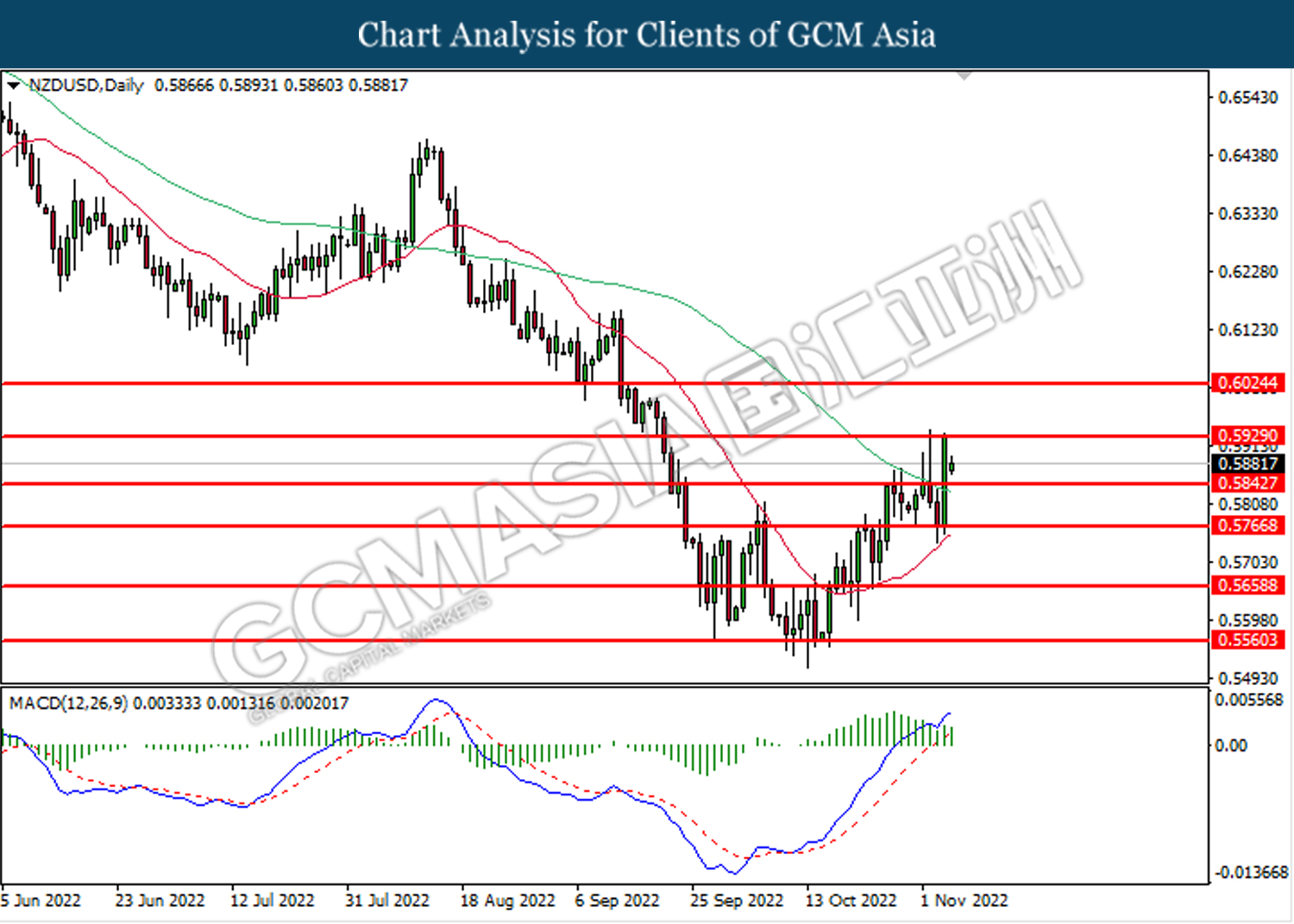

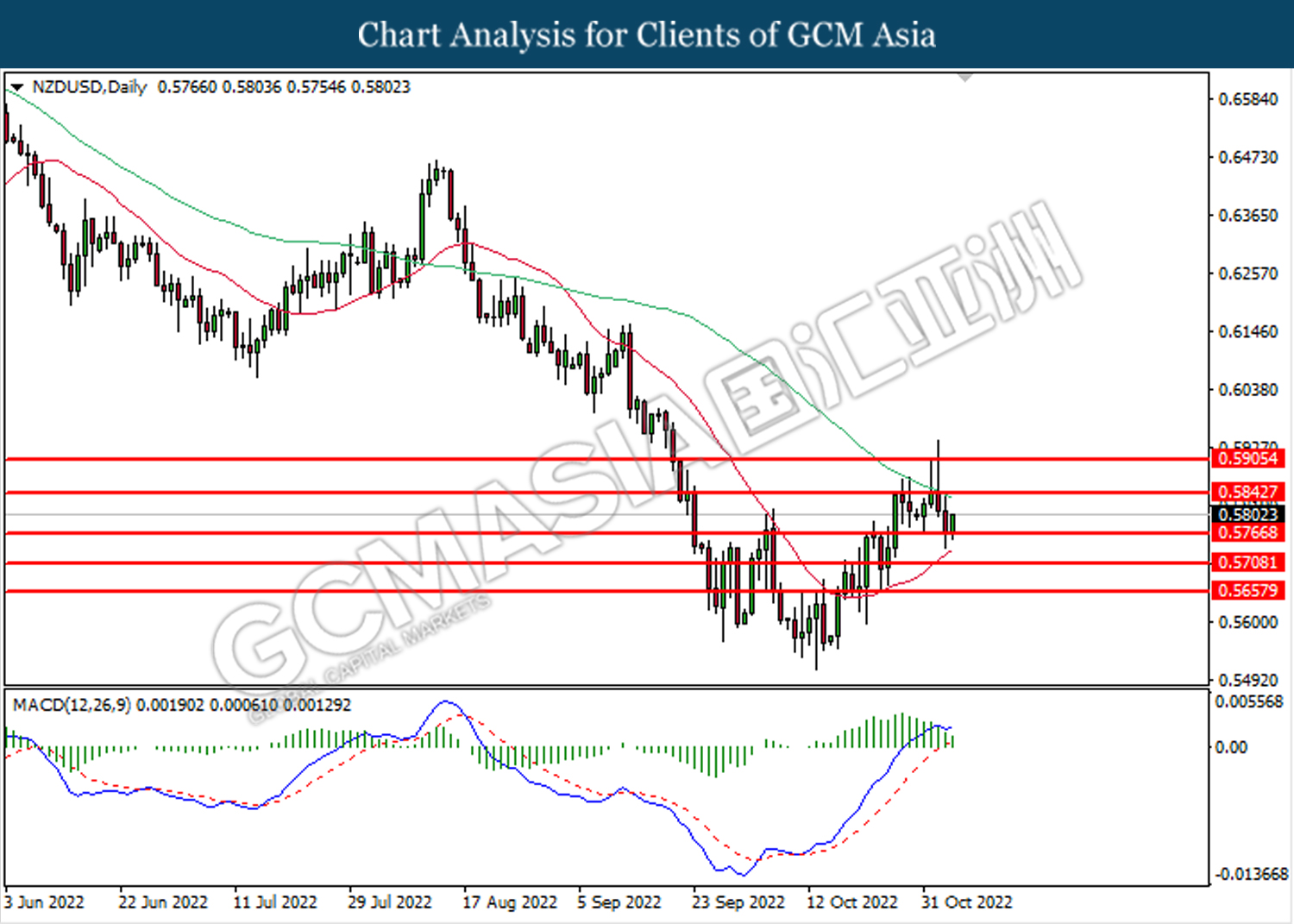

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6105. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6105, 0.6170

Support level: 0.6025, 0.5930

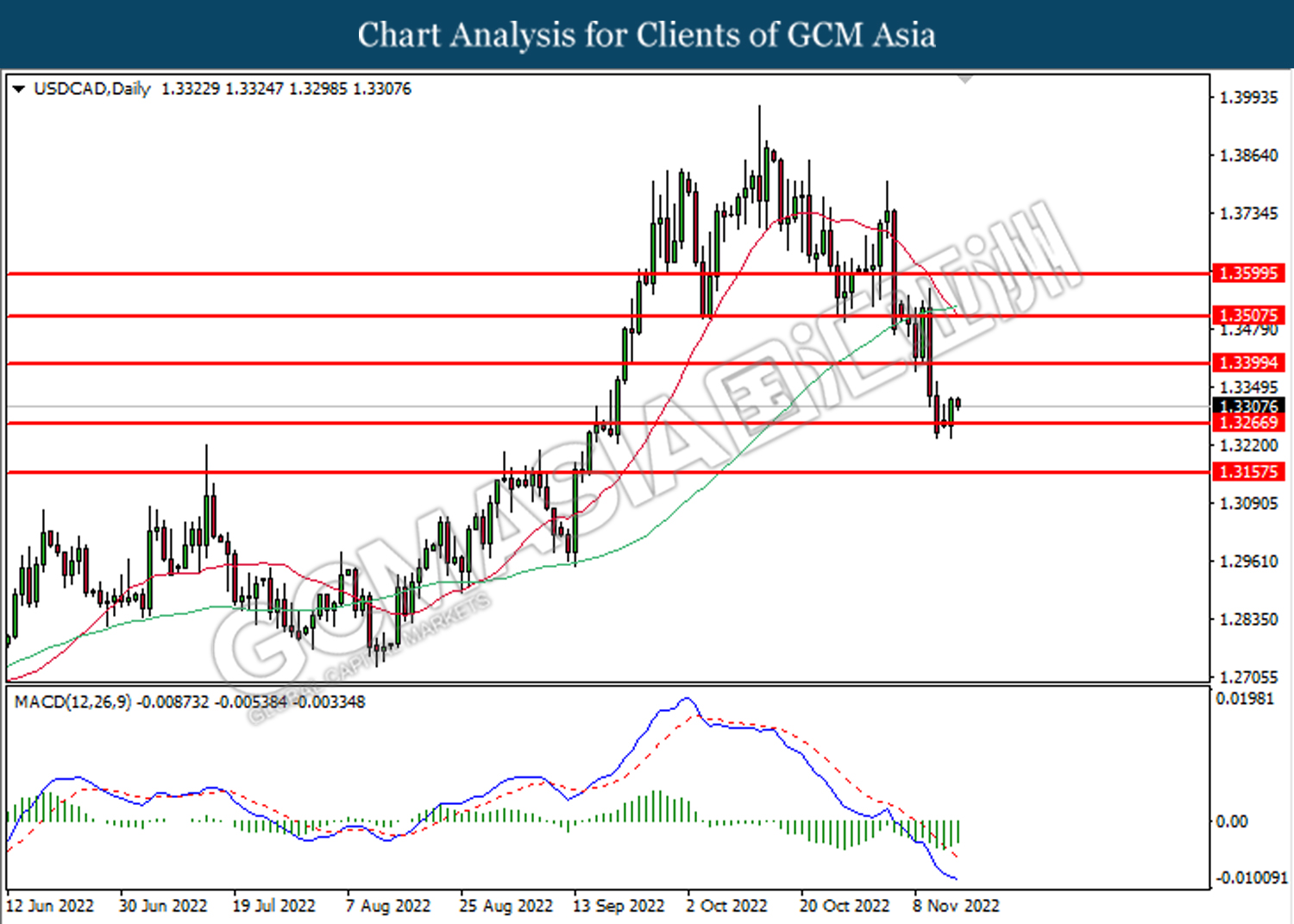

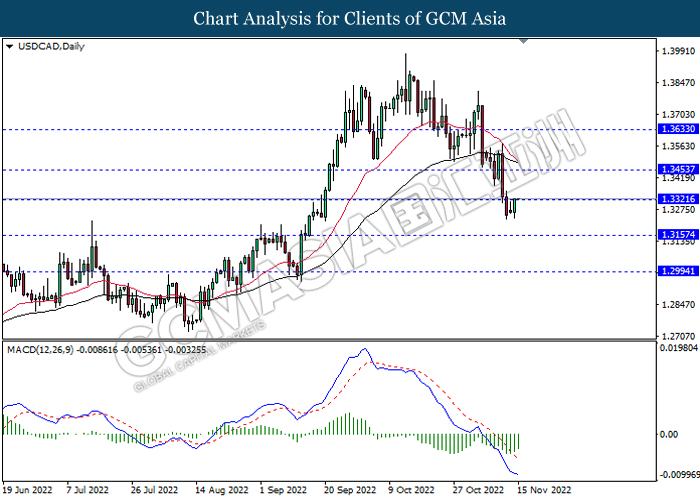

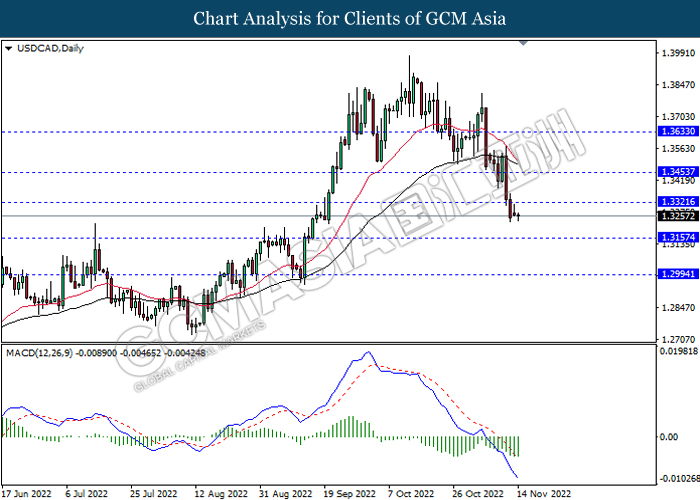

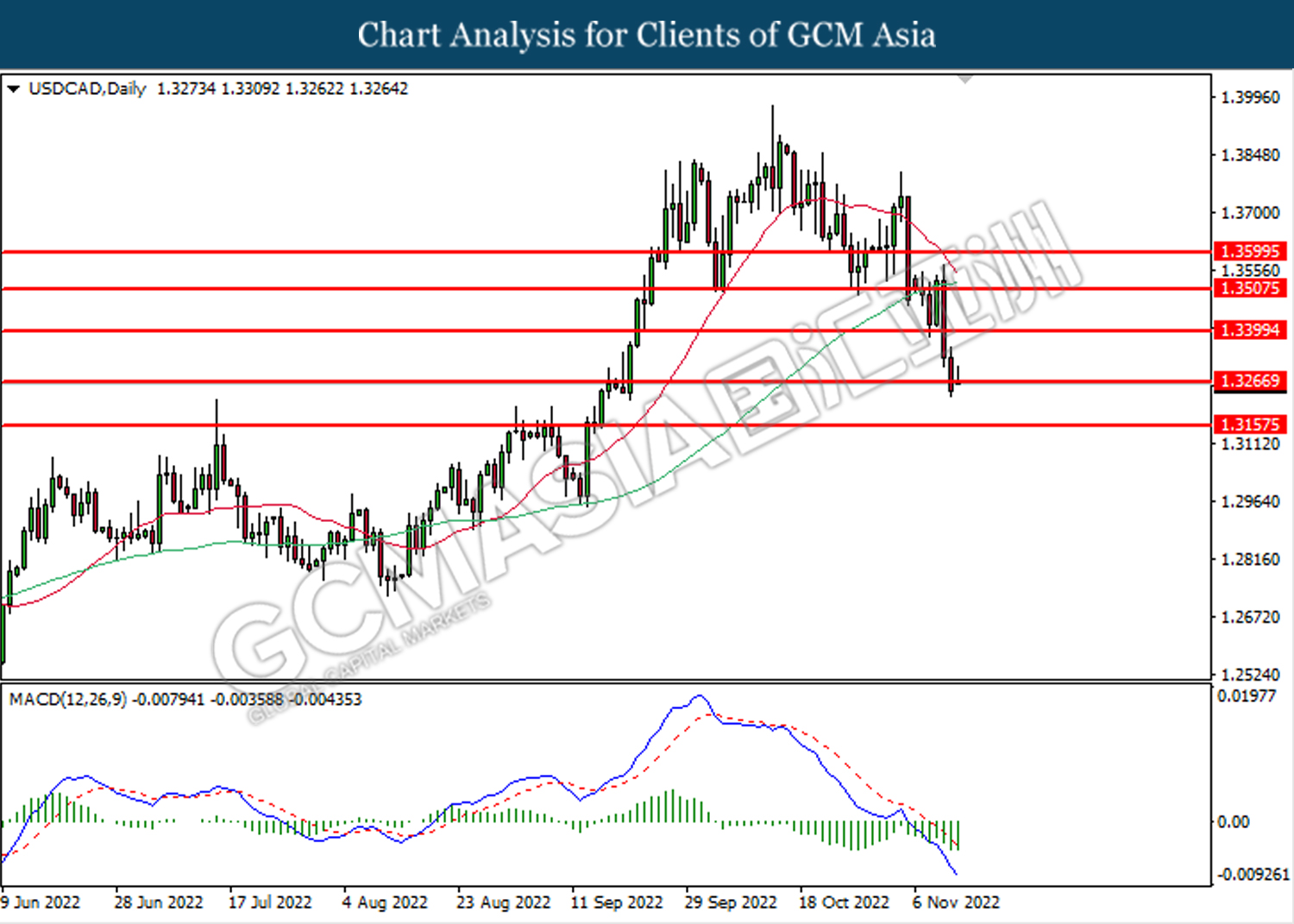

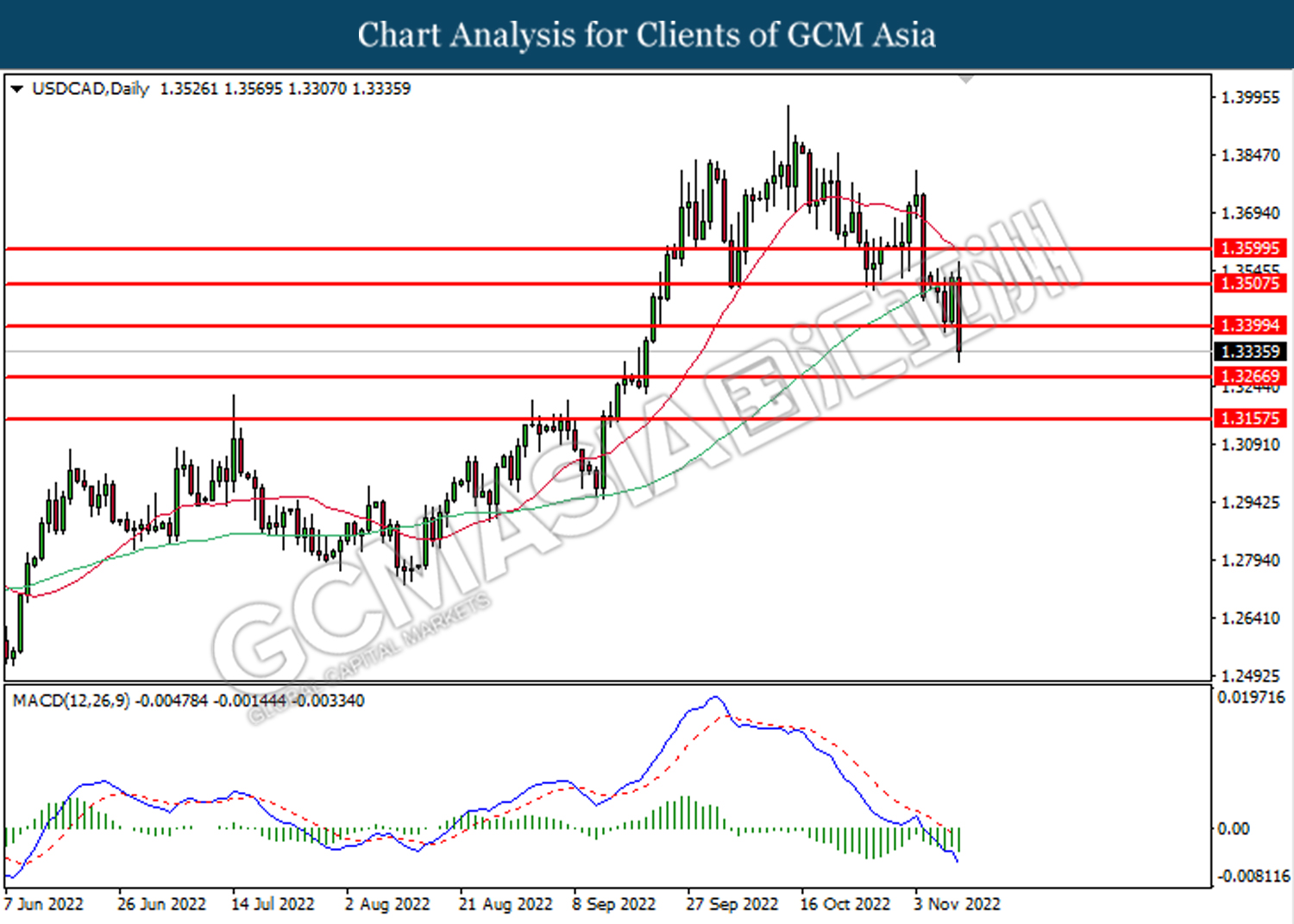

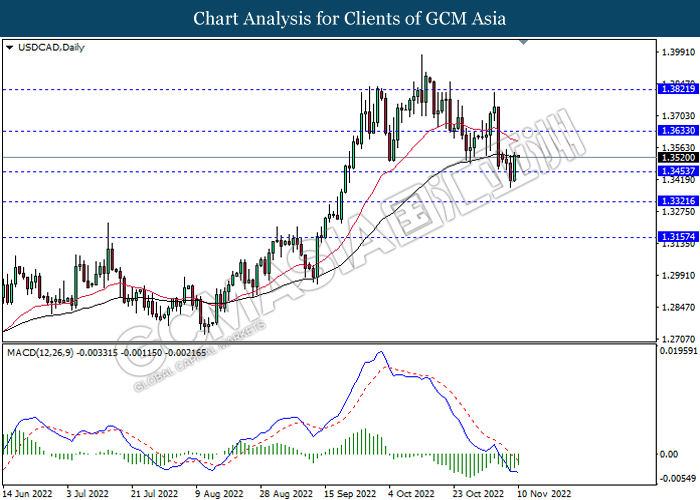

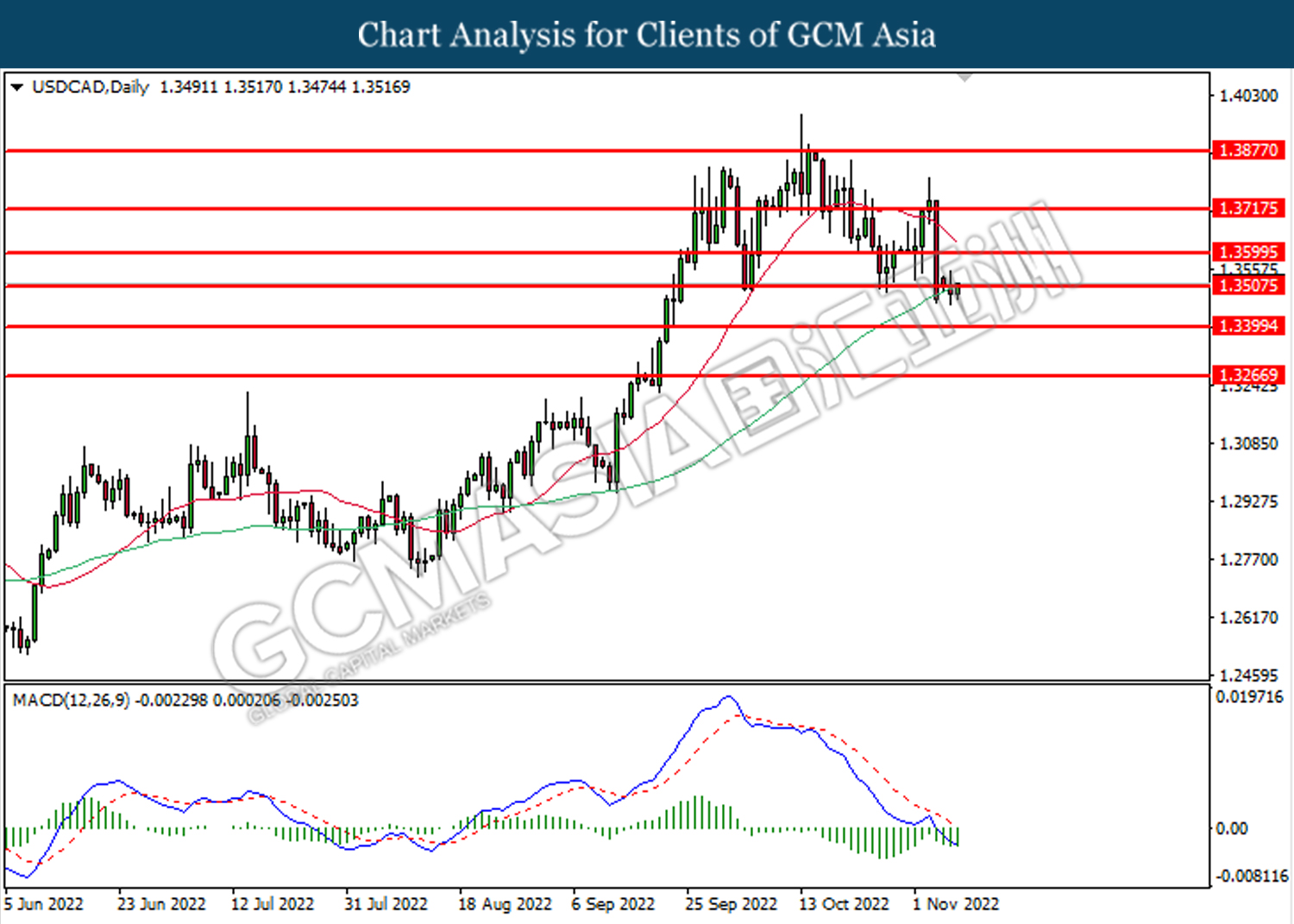

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

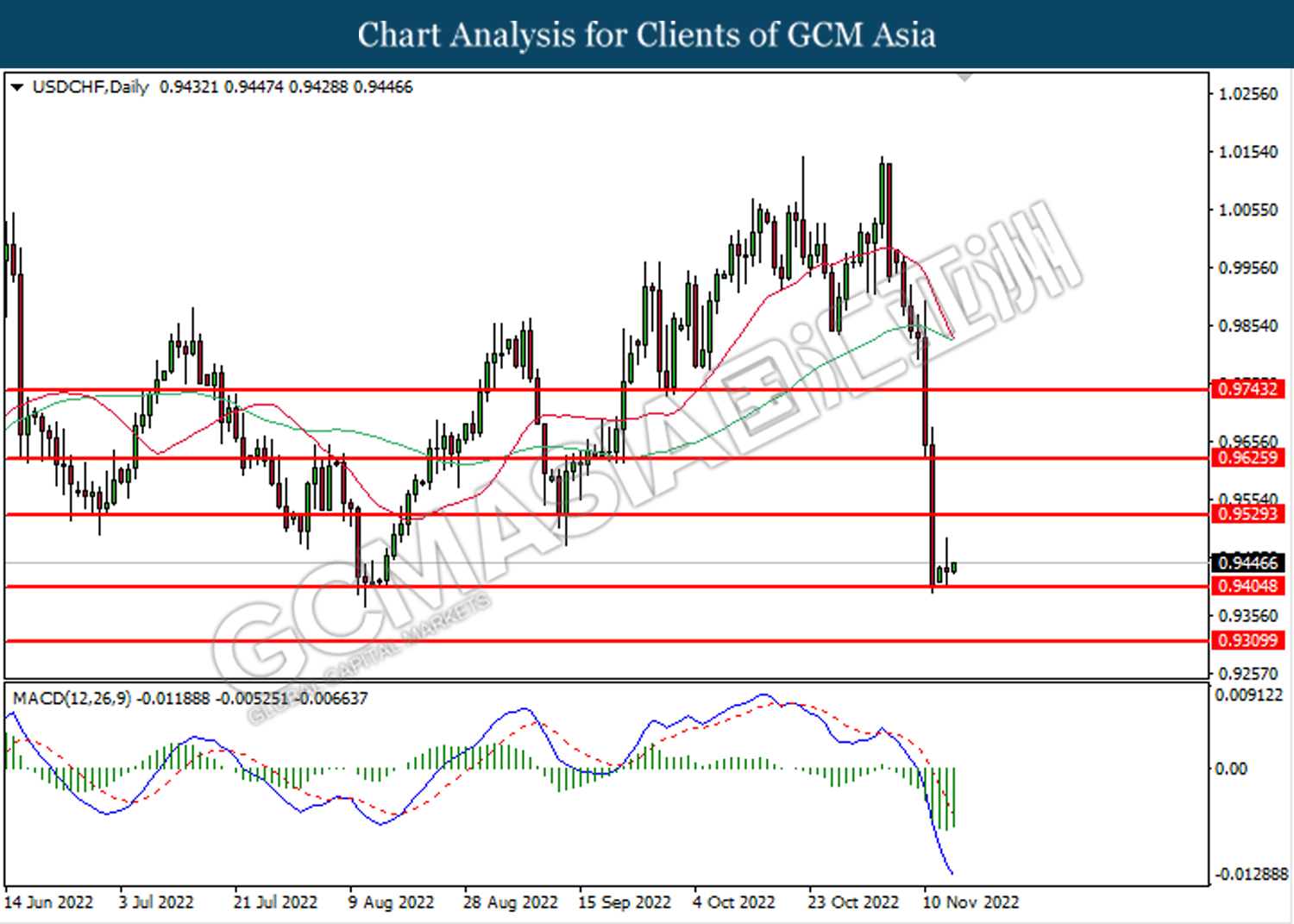

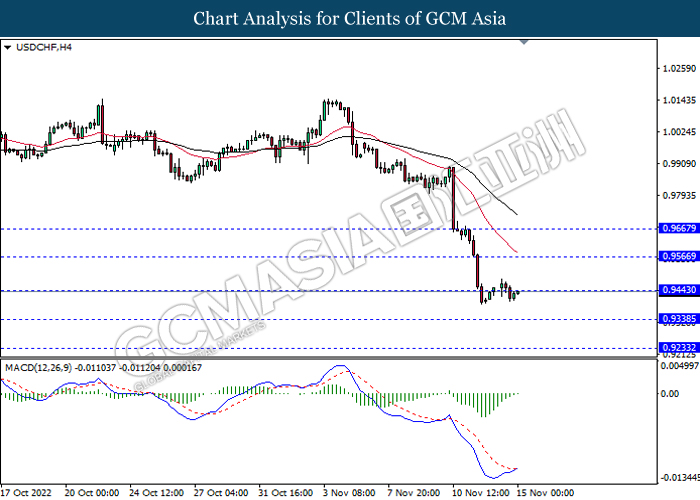

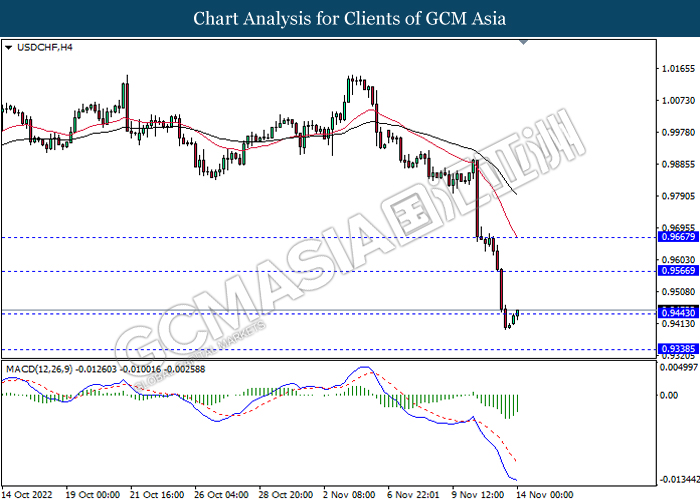

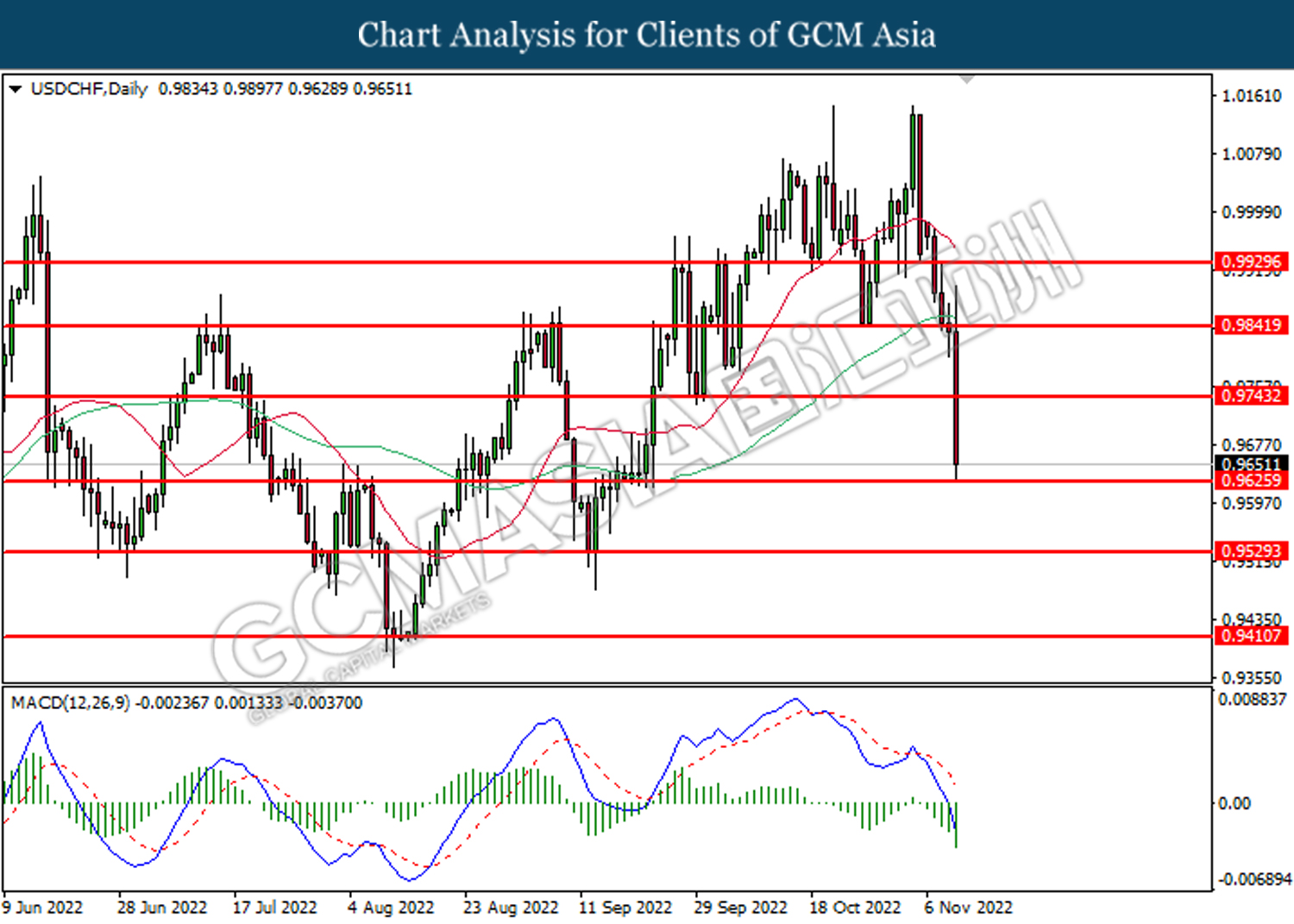

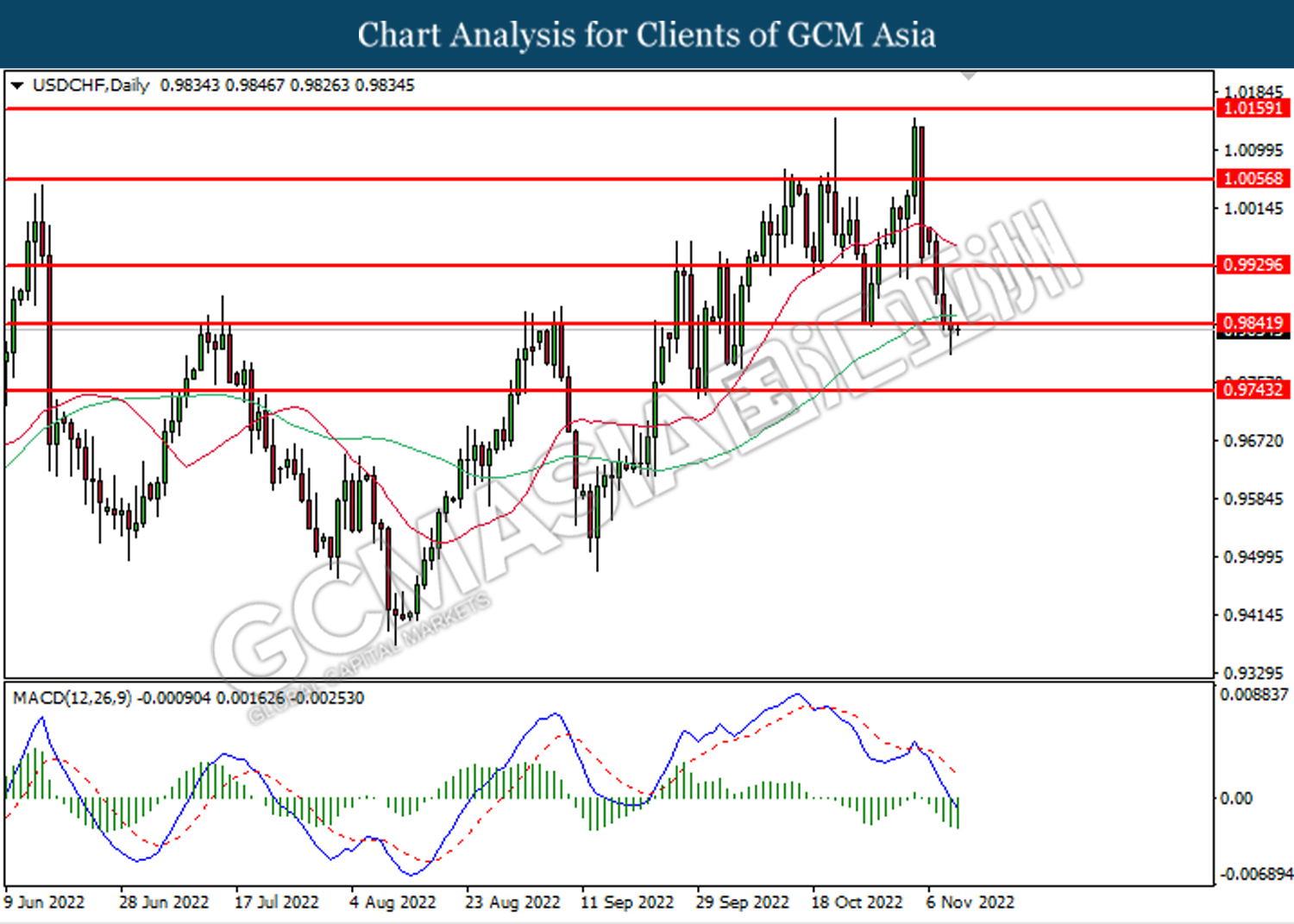

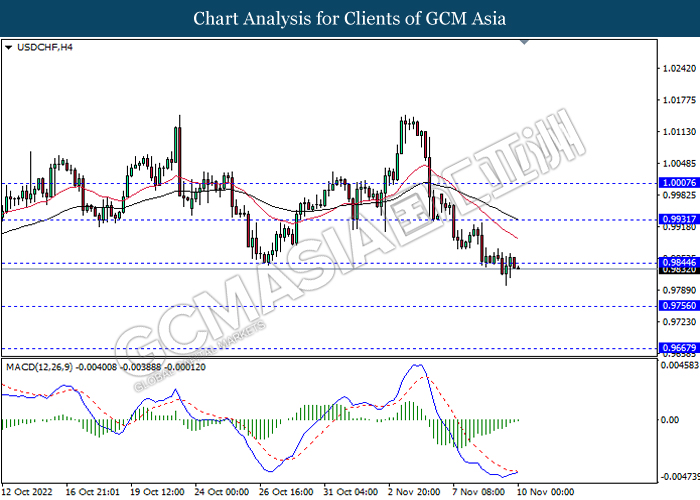

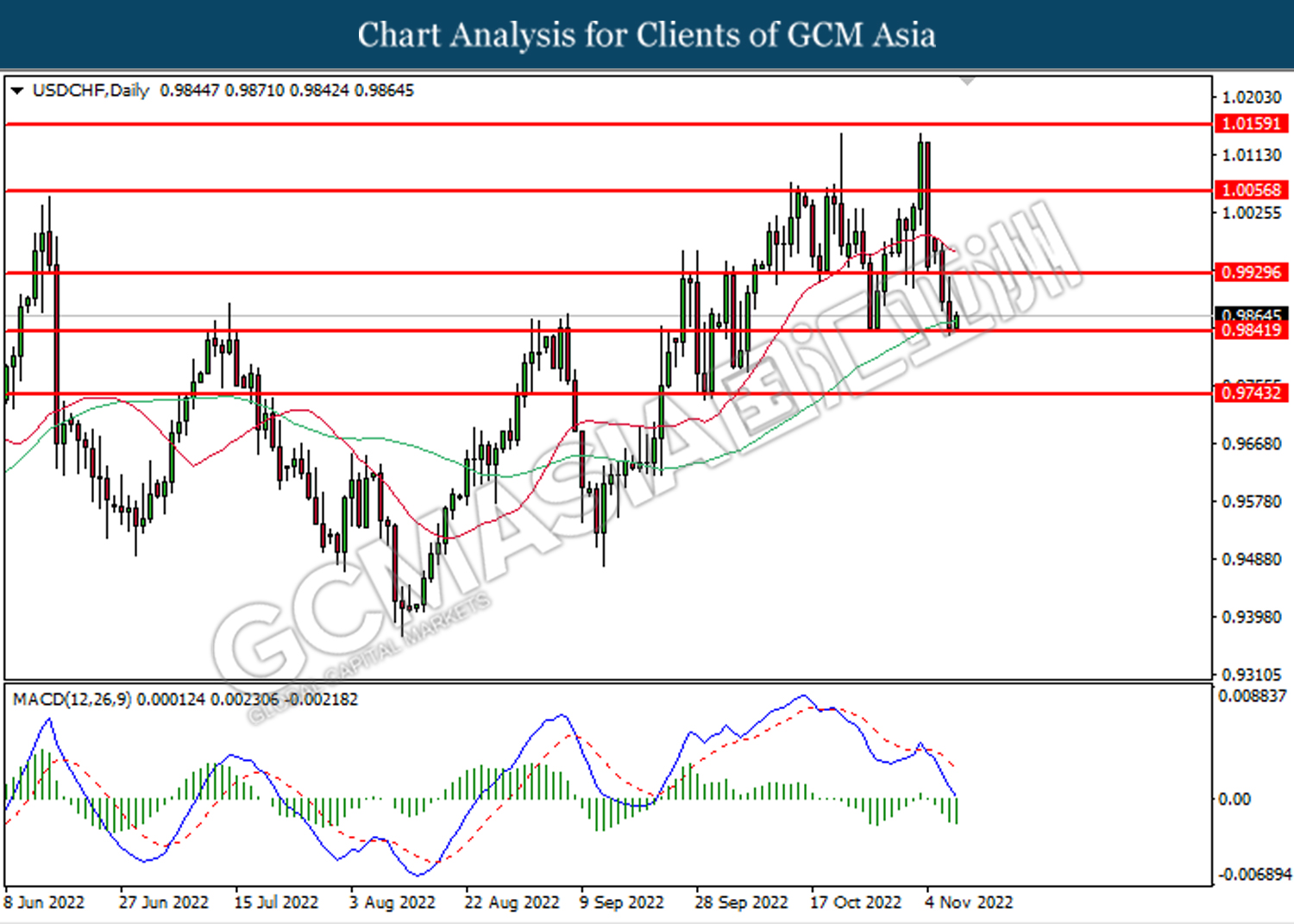

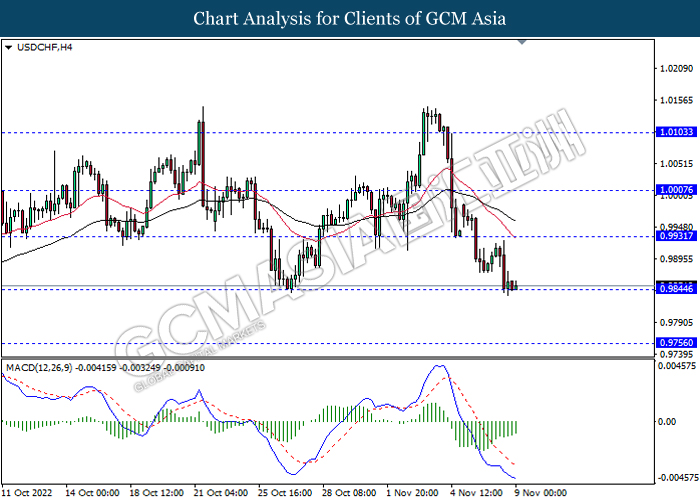

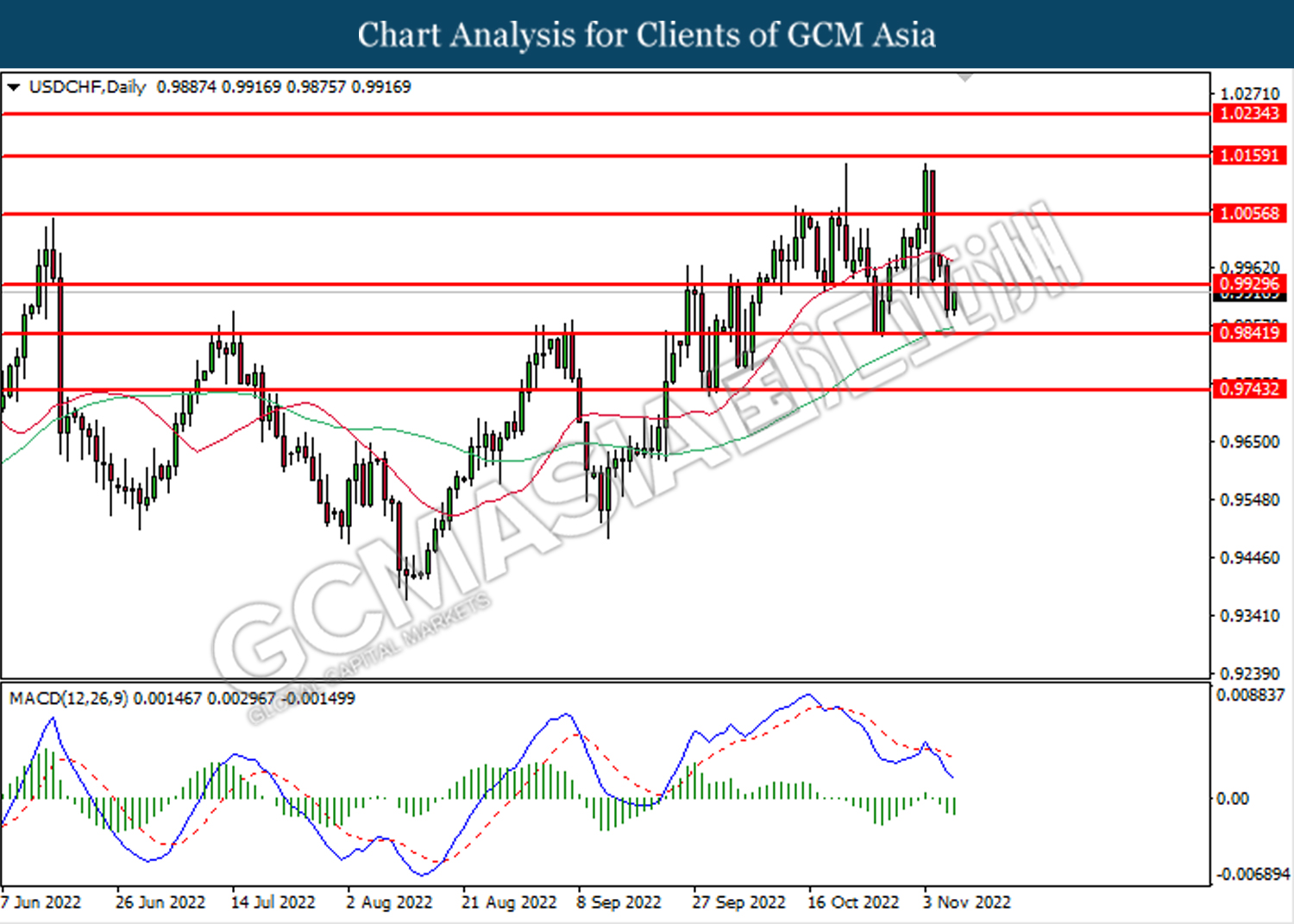

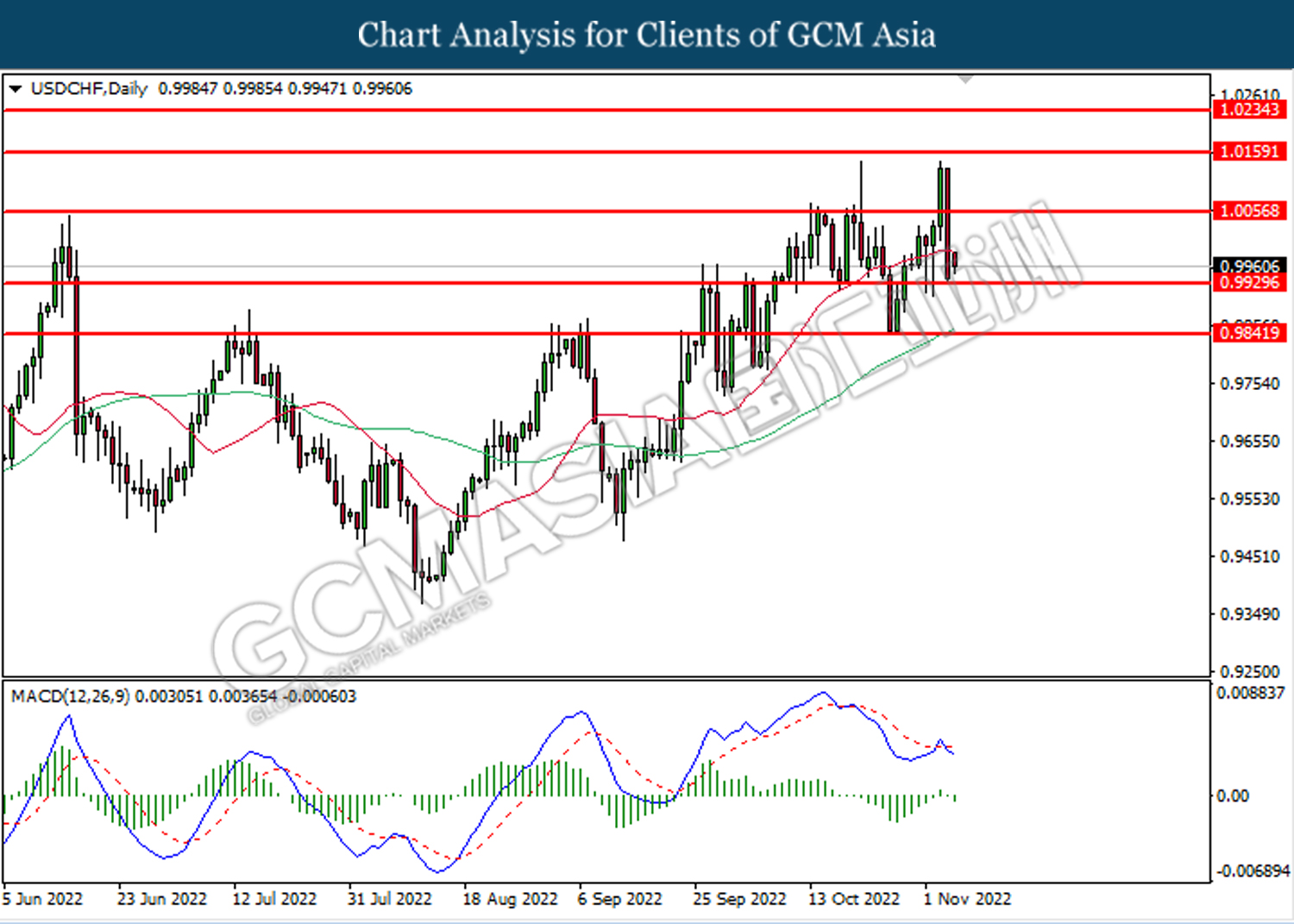

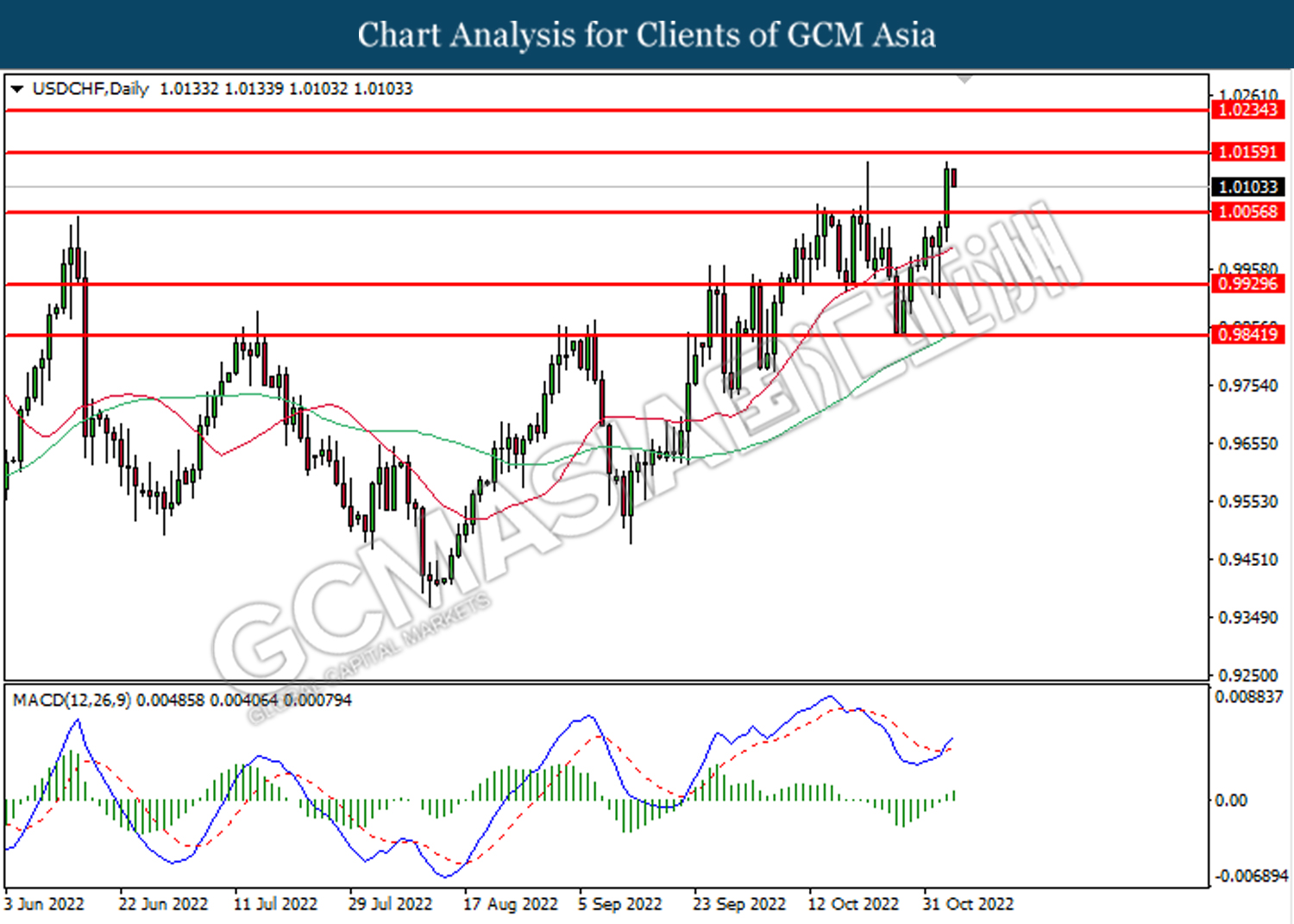

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

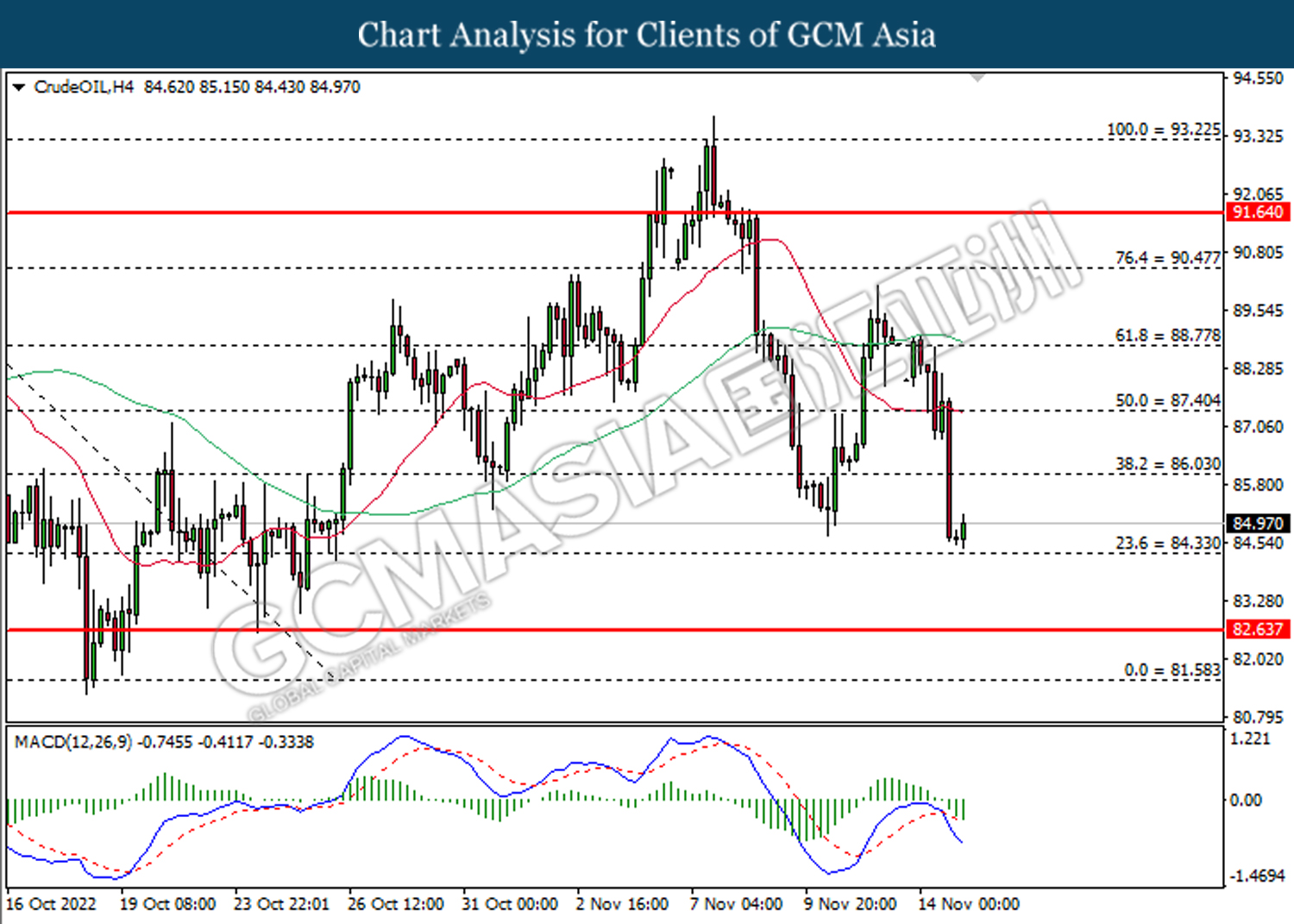

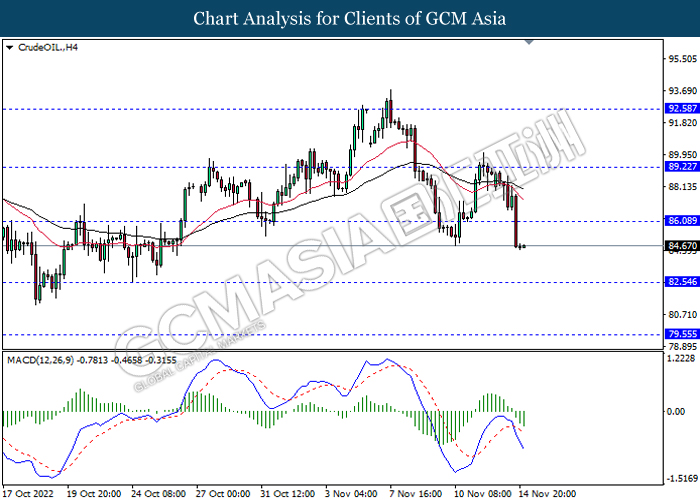

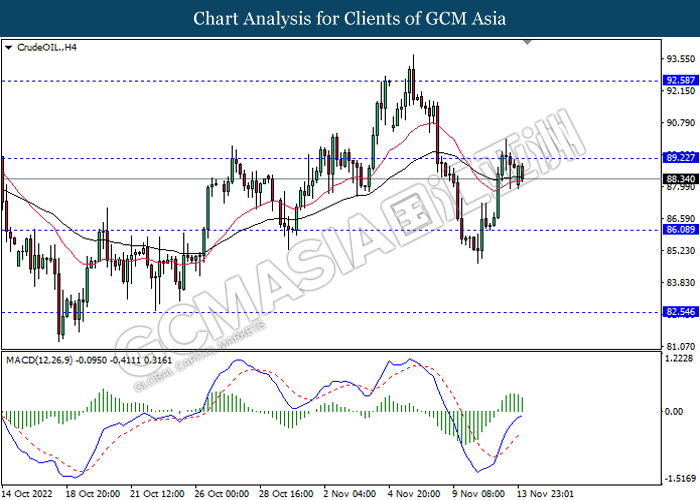

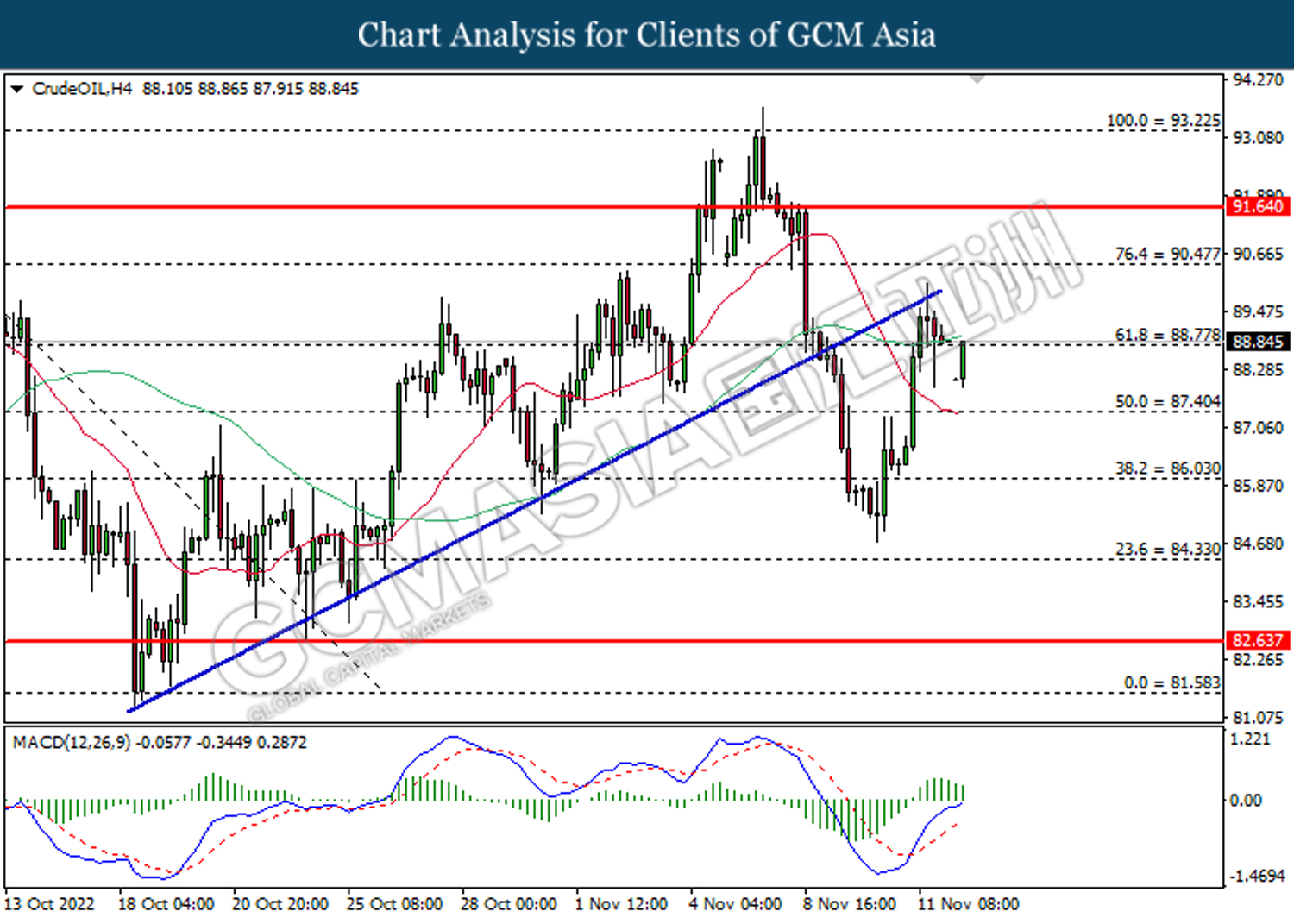

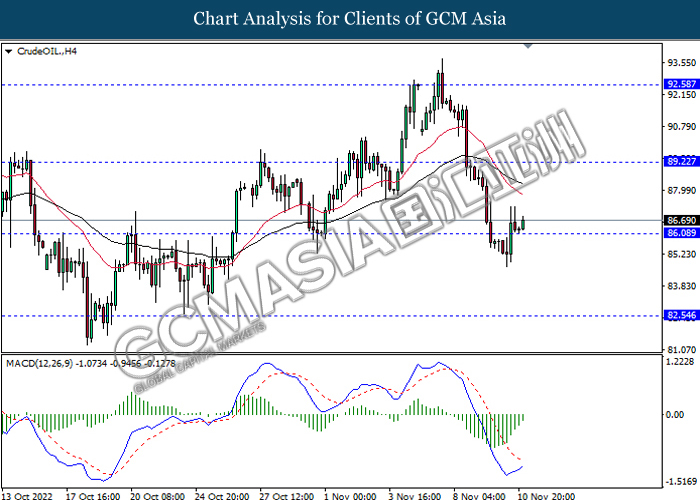

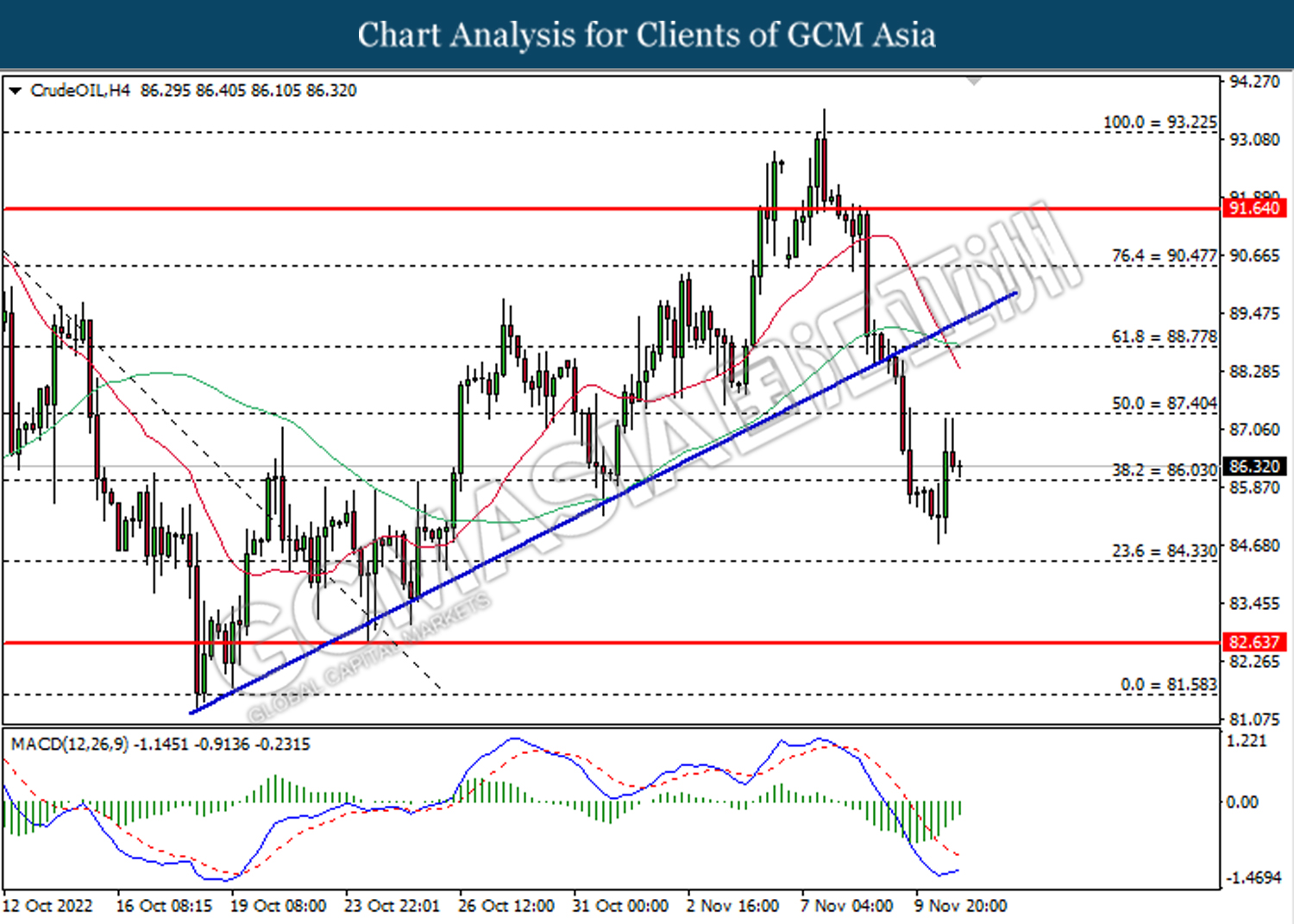

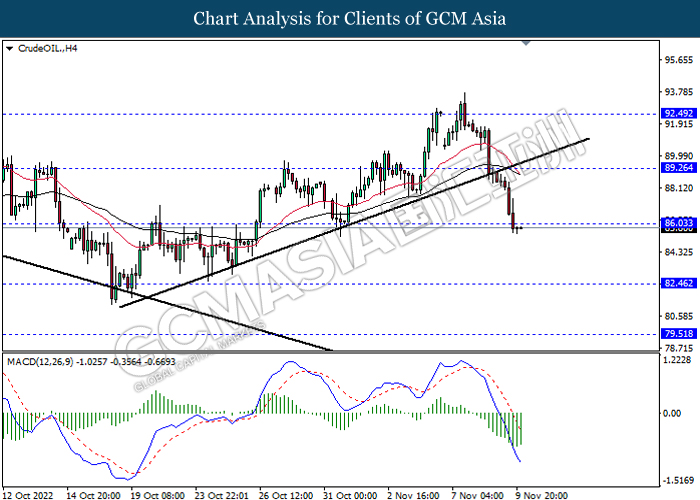

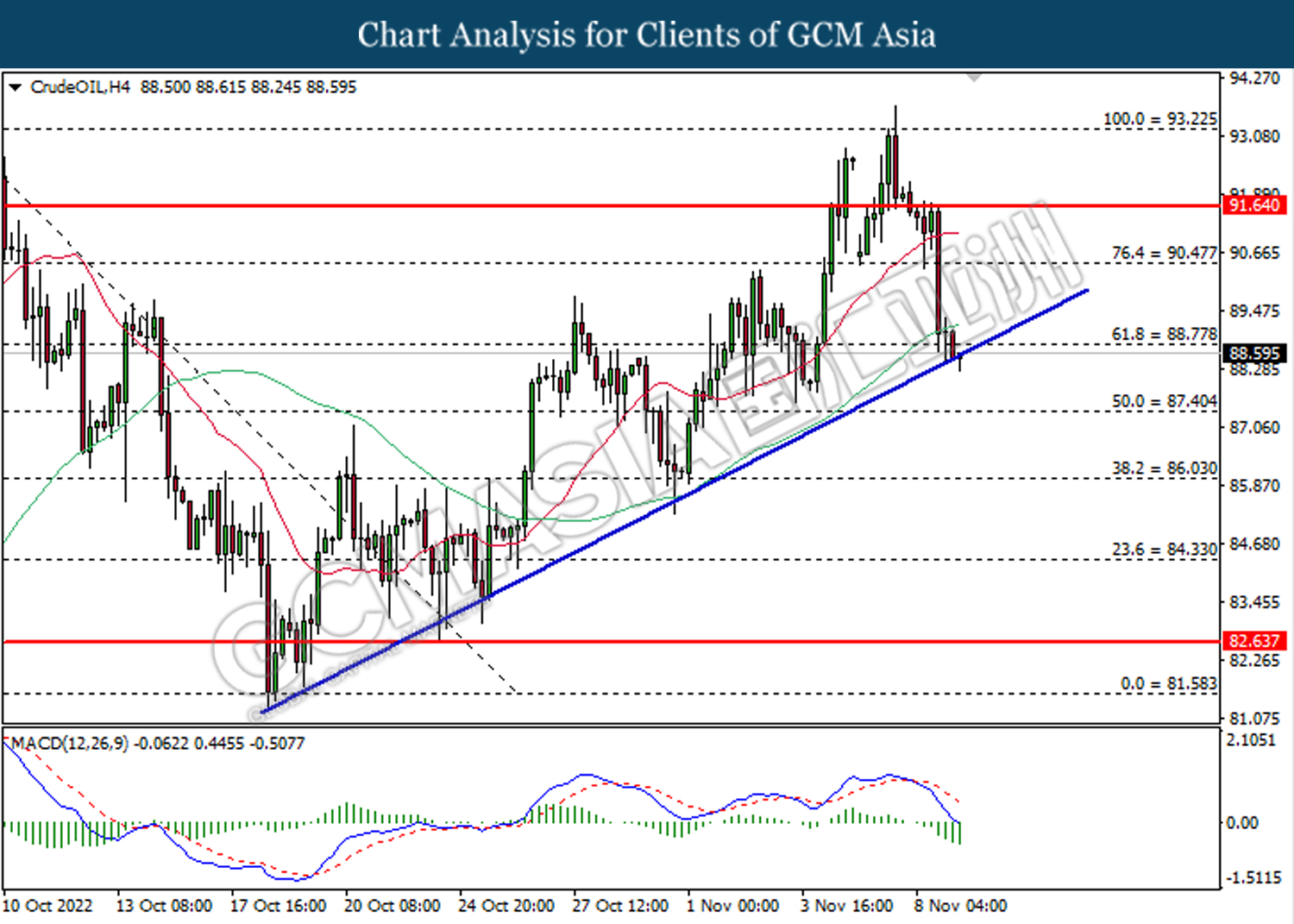

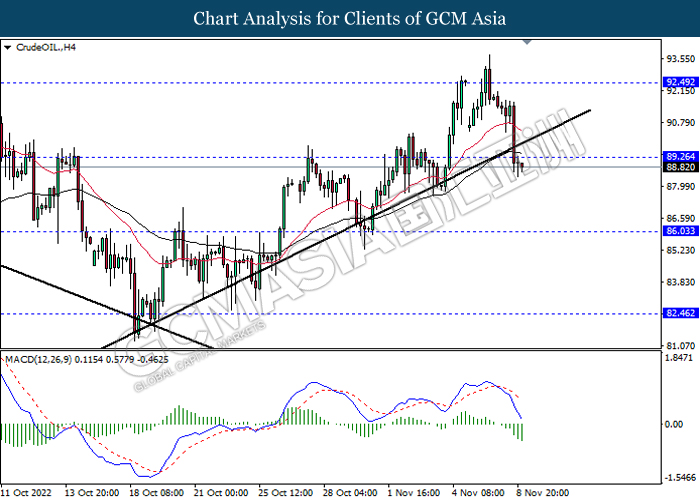

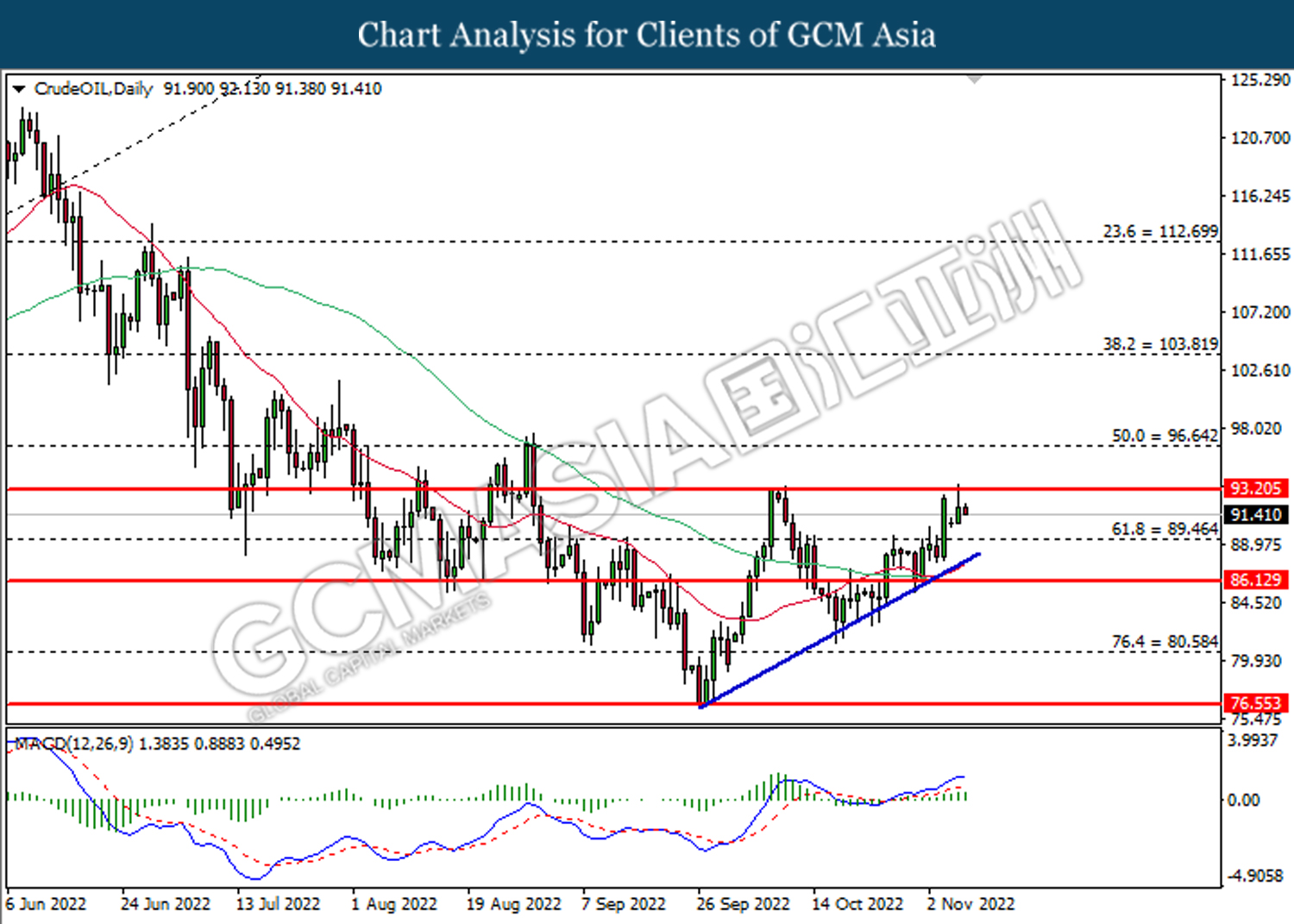

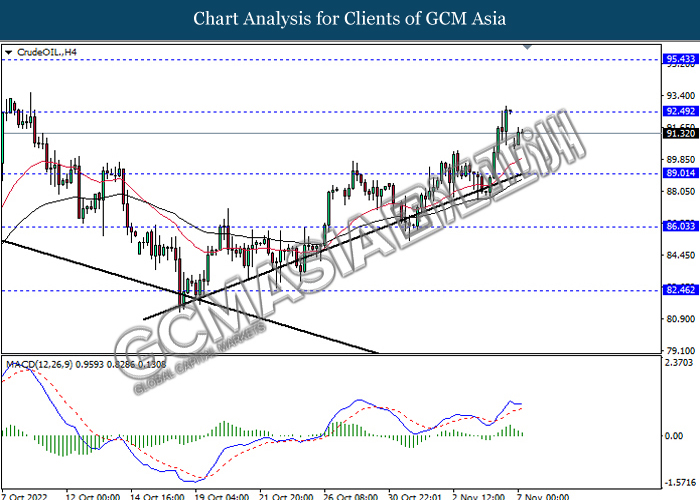

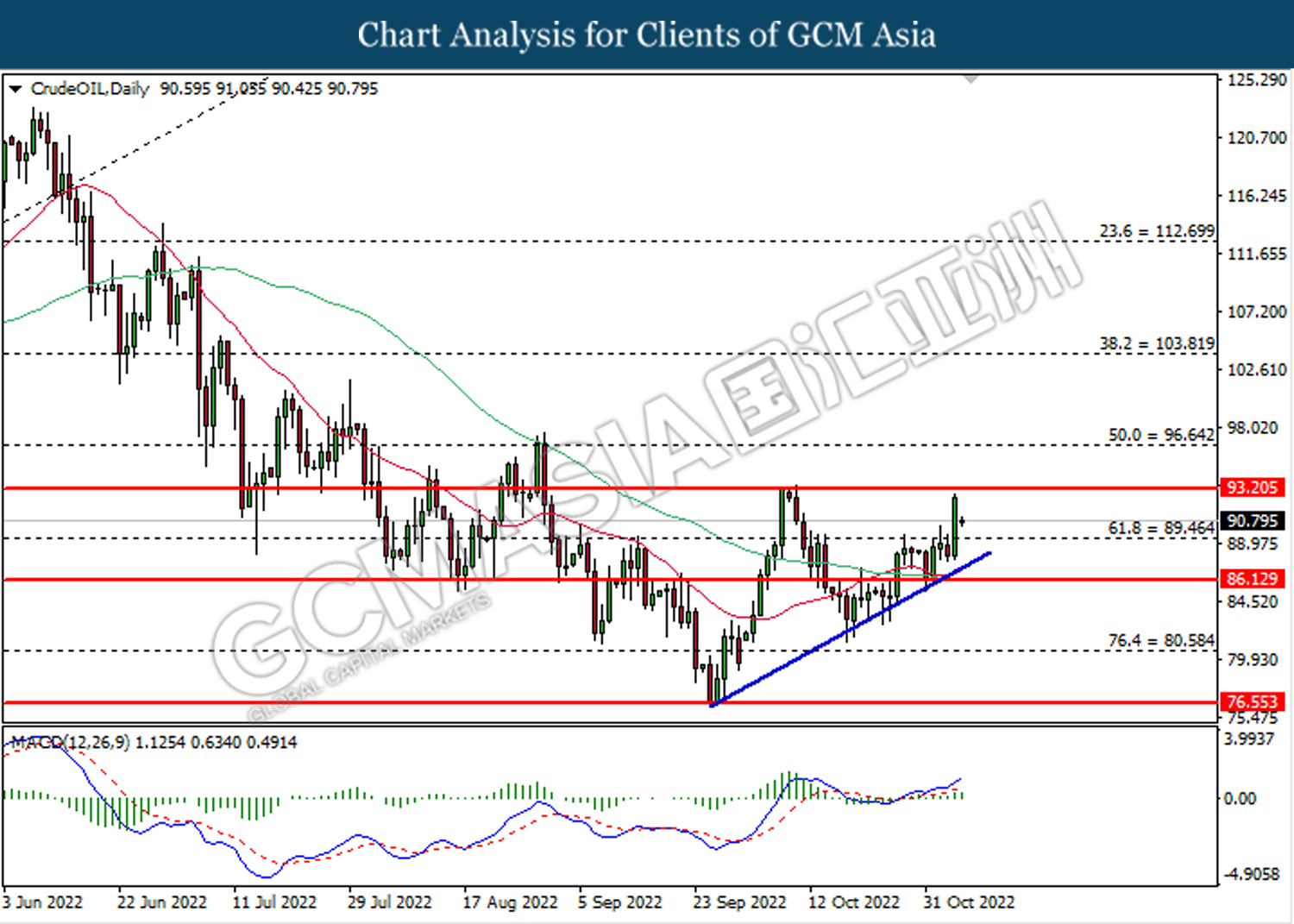

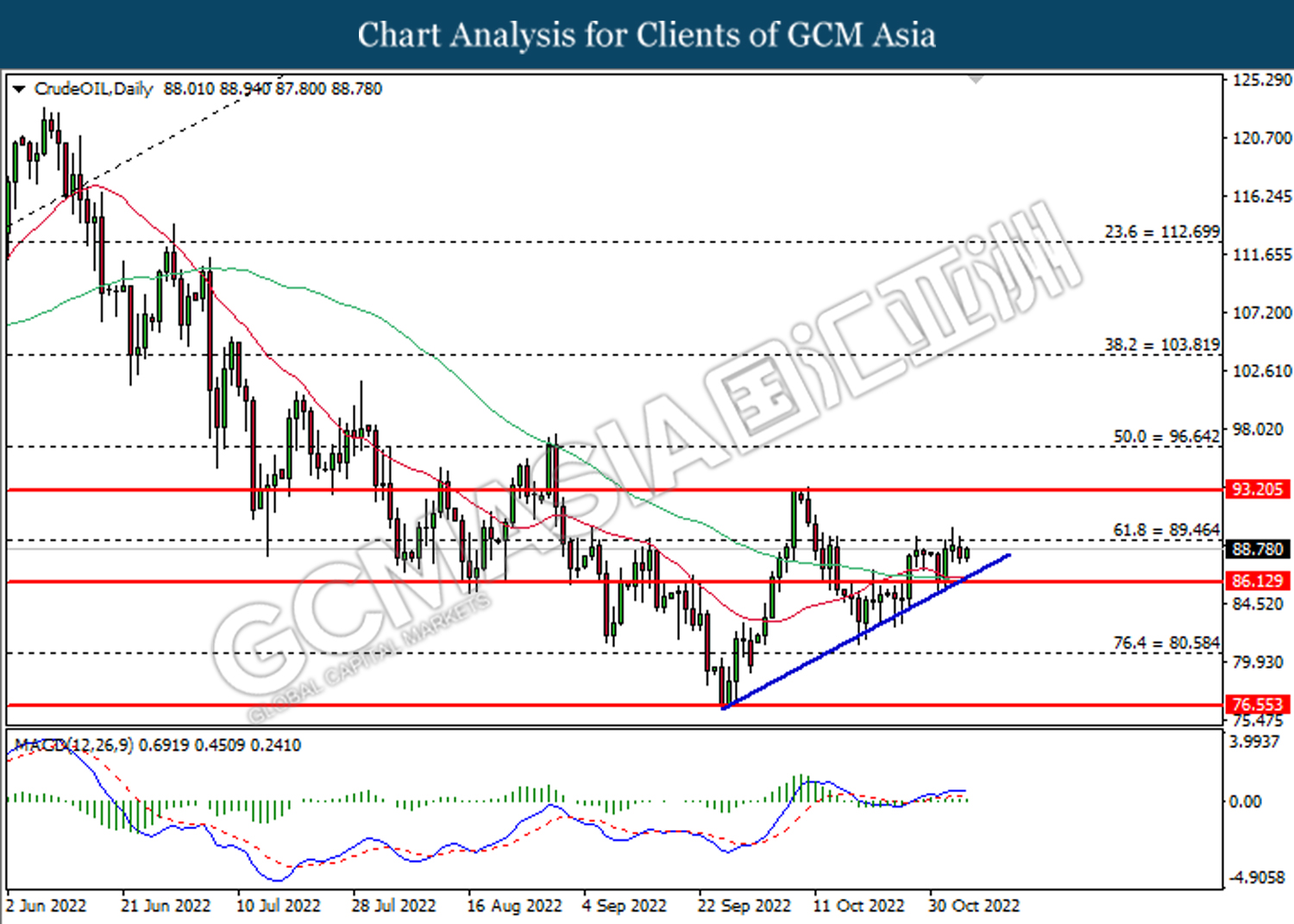

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 84.35. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 86.05, 87.40

Support level: 84.35, 82.65

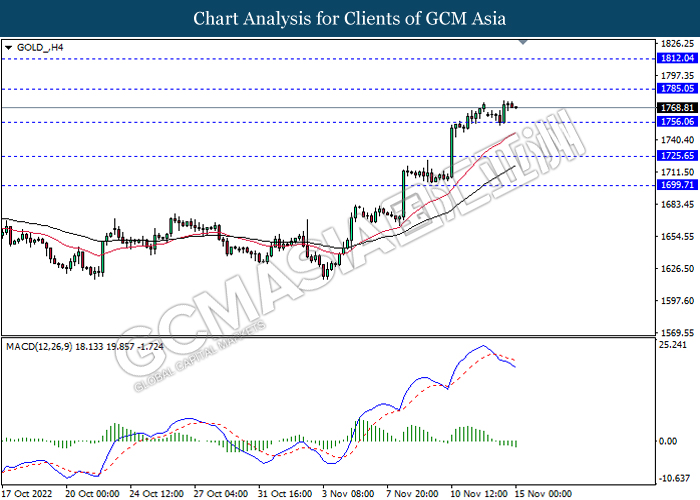

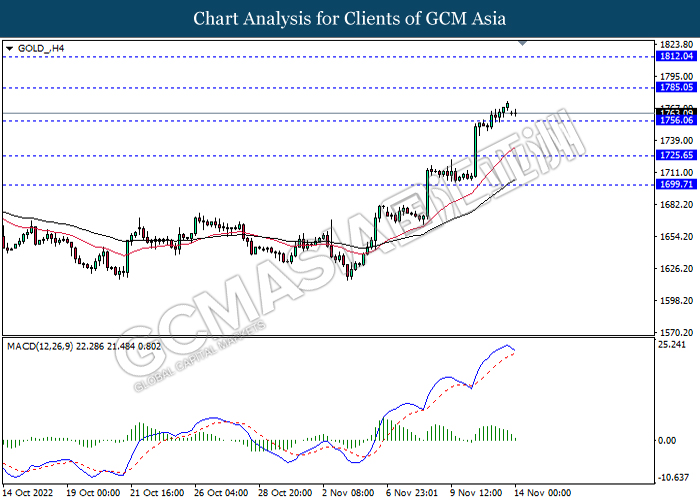

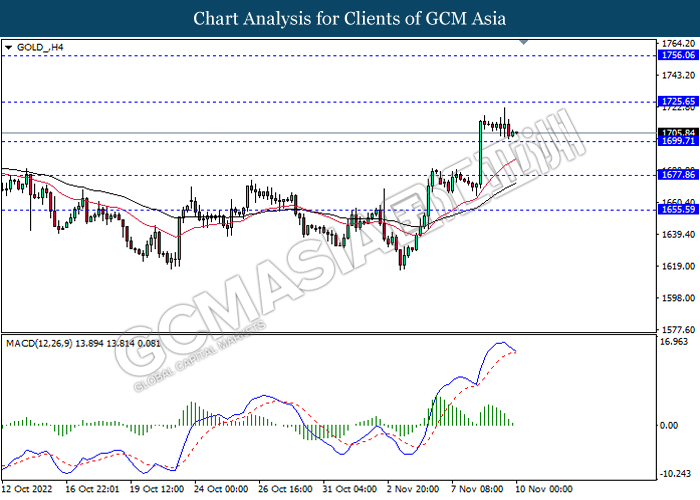

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1805.90.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15

151122 Morning Session Analysis

15 November 2022 Morning Session Analysis

US Dollar hovered as stance of Fed members are mixed.

The Dollar Index which traded against a basket of six major currencies seesawed on yesterday following mixing sounds from Fed officials. Last week, the US CPI has notched down from the prior figure of 8.2% to 7.7%, the fourth consecutive decline since August. With that, some of the Fed members were started considering about a slower pace of rate hike, which 50 basis point of interest rate increase might be implemented. Though, according to Reuters, Federal Reserve Governor Christopher Waller claimed on Monday that the market are overreacted to the October consumer inflation numbers. Waller, one of the Fed’s more hawkish voices, told a conference in Australia that the Fed will likely slow the pace of interest rate hikes from here on, but warned markets should focus less on the pace of tightening than on the ‘end point’ of the cycle. Since the market participants are gauging the Fed’s policy in the December meeting, investors decided to await the latest updates with regards of rate hike decision from Fed before entering the market. As of writing, the Dollar Index appreciated by 0.53% to 106.72.

In the commodities market, the crude oil price rose by 0.14% to $85.33 per barrel as of writing after a sharp decline throughout yesterday trading session amid the surge of China Covid-19 cases. On the other hand, the gold price depreciated by 0.10% to $1769.69 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Sep) | 6.0% | 6.0% | – |

| 15:00 | GBP – Claimant Count Change (Oct) | 25.5K | – | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Nov) | -59.2 | -50.0 | – |

| 21:00 | USD – PPI (MoM) (Oct) | 0.4% | 0.5% | – |

Technical Analysis

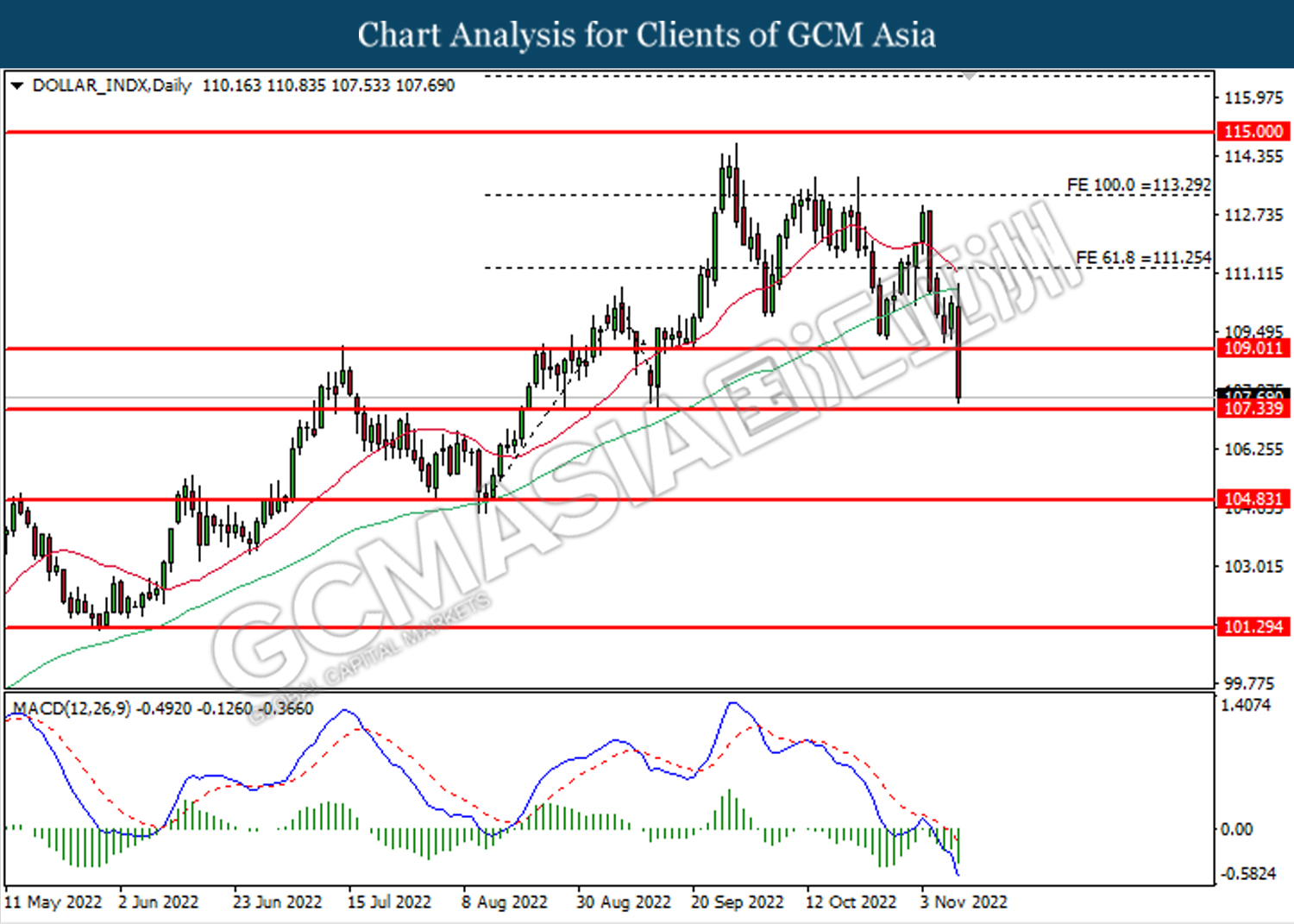

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1835, 1.2040

Support level: 1.1635, 1.1370

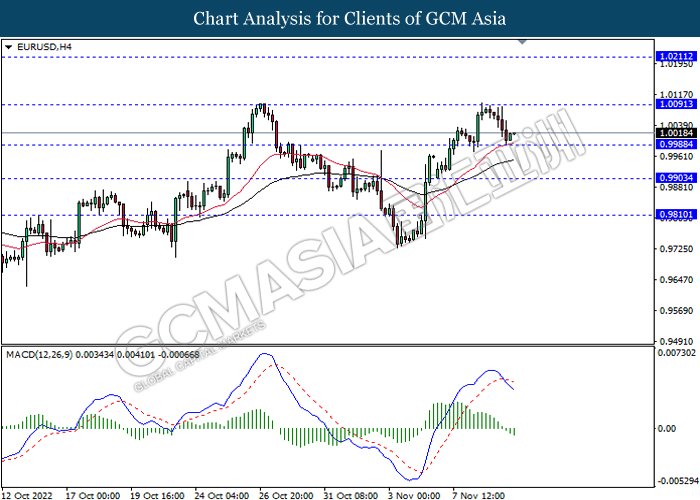

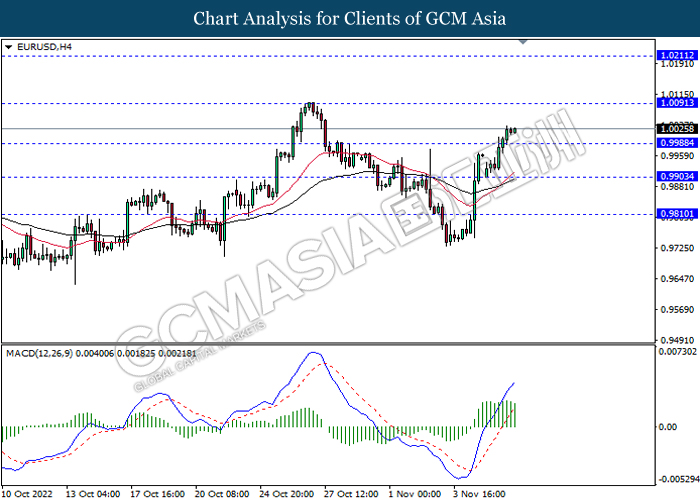

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

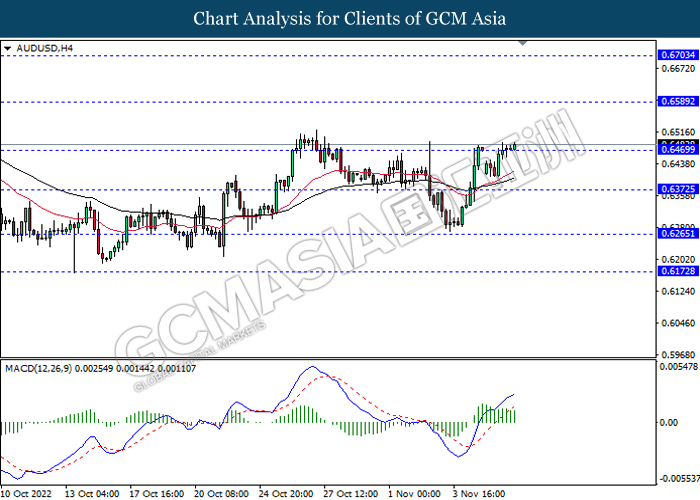

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6470

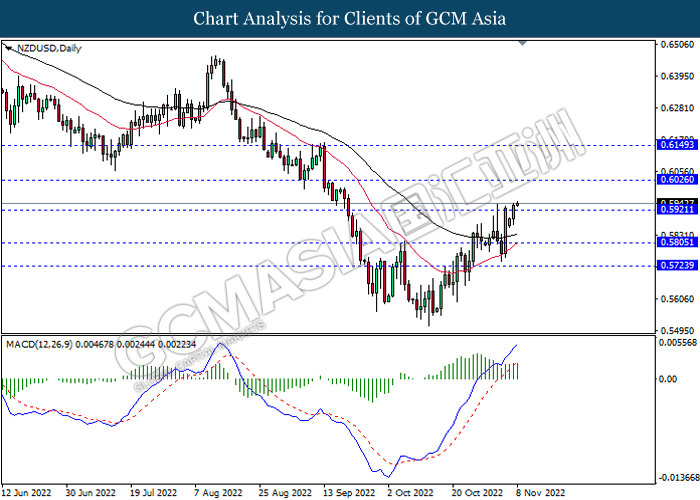

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3320, 1.3455

Support level: 1.3155, 1.2995

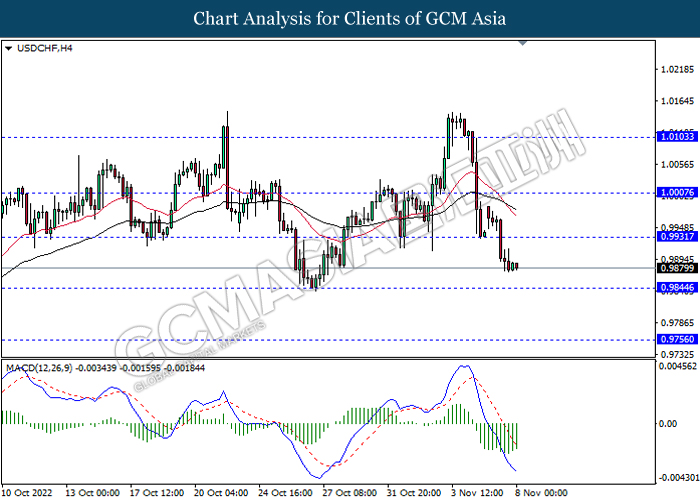

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9445, 0.9565

Support level: 0.9340, 0.9235

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 86.10, 89.20

Support level: 82.55, 79.55

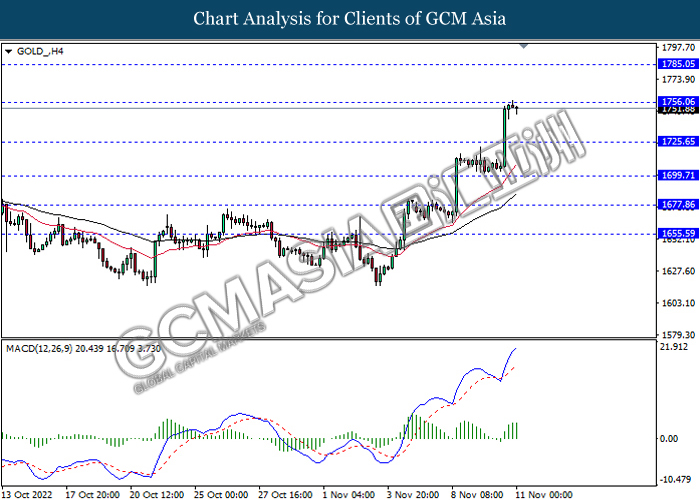

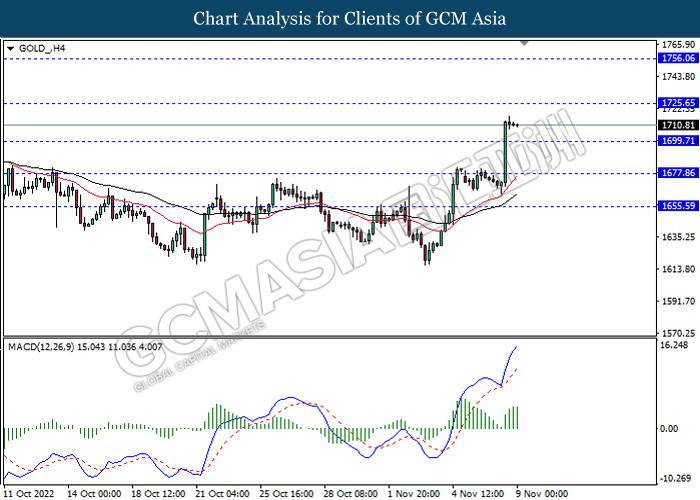

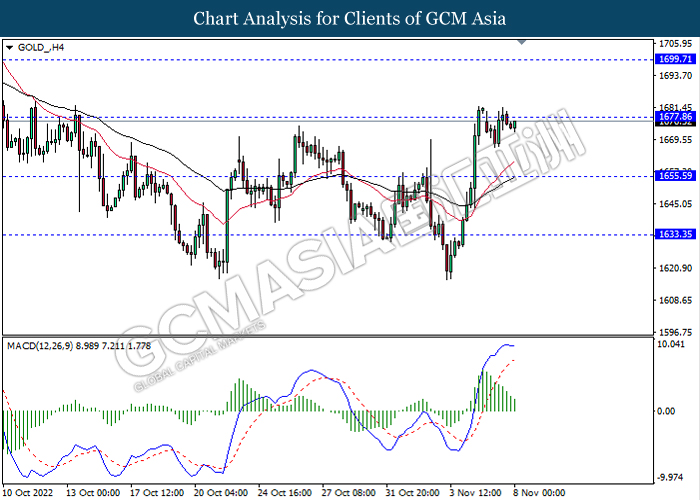

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65

141122 Afternoon Session Analysis

14 November 2022 Afternoon Session Analysis

Pound Sterling’s bulls continues upon optimistic economic data.

The GBP/USD, which widely traded by majority of investors surged on last Friday after the upbeat economic data has been released. According to Office for National Statistics, the UK Gross Domestic Product (GDP) YoY came in at the reading of 2.4%, exceeding the market forecast of 2.1%. Furthermore, the UK Manufacturing Production MoM in September has shown the expansion in the UK manufacturing sector, which it notched up from the prior figures of -1.6% to 0.0%. A series of bullish economic data has dialed up the market optimism toward economic progression in the UK. Besides, the hawkish statement from Bank of England (BoE) member has spurred further bullish momentum on Pound Sterling. According to Reuters, BoE interest rate-setter Jonathan Haskel claimed on 11 November that the economy recession in UK did not imply a need of slowing aggressive rate hike path, as well as the central bank should keep on the tightening monetary policy to dampen inflationary risk. With that, it stoked a shift in sentiment toward UK currency. As of writing, GBP/USD eased by 0.41% to 1.1789.

In the commodities market, the crude oil price appreciated by 0.35% to $89.27 per barrel as of writing following the looming curbs on Russian oil shipments also appeared set to tighten supply. On the other hand, the gold price edged down by 0.04% to $1765.34 per troy ounce as of writing following the slightly rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1835, 1.2040

Support level: 1.1635, 1.1370

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6470

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3320, 1.3455

Support level: 1.3155, 1.2995

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 89.20, 92.60

Support level: 86.10, 82.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65

141122 Morning Session Analysis

14 November 2022 Morning Session Analysis

Unstoppable losses in dollar market amid the easing in inflation.

The dollar index, which gauges its value against a basket of six major currencies, failed to recoup its losses last Friday as the investors favored riskier currencies as the cooling down in CPI data has not been fully digested by the investors yet. Last Thursday, the US Bureau of Statistics released its long-waited CPI data with a lower-than-expected result. With that, the dollar lost its ground and fell across the board for two consecutive trading sessions. The weaker-than-expected CPI data boosted the chance that the Federal Reserve might slow down the hefty rate hikes, whereby the case of a 50 basis point rate hike is likely to happen in the Fed’s December meeting. On the other hand, the dollar index dropped further as the investor’s risk appetite jumped as Chinese health authorities decided to ease the country’s Covid-19 restrictions, including reducing the quarantine times for close contacts cases and inbound travelers. As of writing, the dollar index plummeted by -1.65% to 106.40.

In the commodities market, the crude oil price increased by 0.05% to $88.05 per barrel as the shift away from China’s Zero Covid policy is likely to boost the oil demand in the future. Besides, the gold price went up by 0.05% to $1771.40 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1820, 1.2000

Support level: 1.1635, 1.1445

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6640. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6725.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6105. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6105, 0.6170

Support level: 0.6025, 0.5930

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3265. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 88.75. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 88.75, 90.45

Support level: 87.40, 86.05

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

111122 Afternoon Session Analysis

11 November 2022 Afternoon Session Analysis

Euro rallied over the ECB hawkish stance.

The EUR/USD, which widely traded by majority of investors surged on yesterday amid the hawkish statement from European Central Bank (ECB) policymakers. According to Reuters, three of the ECB policymakers claimed on Thursday that the aggressive rate hike was necessary in order to tame sky-high inflationary pressure which faced by Eurozone. The Eurozone CPI that unleashed on October has reached a high level of 10.7%, as well as it did not show a sign of diminishing. Besides, the ECB board member Isabel Schnabel had reiterated that there is no time to pause the contractionary monetary policy, which sparkling the appeal of Euro. On the other hand, the GBP/USD rose significantly during overnight trading session over the Bank of England gilt selling plan. The BoE would start selling its bonds on 29 November. By doing this, the circulation of Pound Sterling in the market would likely to be reduced, which spurring bullish momentum on the GBP/USD. As of writing, EUR/USD depreciated by 0.21% to 1.0187 while GBP/USD eased by 0.31% to 1.1677.

In the commodities market, the crude oil price rose by 0.38% to $86.81 per barrel as of writing upon the tight oil supply, which caused by the price cap which implemented on Russia crude oil. In addition, the gold price appreciated by 0.05% to $1751.13 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 4.4% | 2.1% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Sep) | -1.6% | -0.4% | – |

| 15:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.4% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 108.45, 109.95

Support level: 107.05, 105.20

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1835, 1.2040

Support level: 1.1635, 1.1370

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0210, 1.0335

Support level: 1.0090, 0.9990

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6470

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully brekaut the resistance level.

Resistance level: 0.6025, 0.6150

Support level: 0.5920, 0.5805

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9665, 0.9755

Support level: 0.9565, 0.9445

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 89.20, 92.60

Support level: 86.10, 82.55

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1756.05, 1785.05

Support level: 1725.65, 1699.70

111122 Morning Session Analysis

11 November 2022 Morning Session Analysis

Dollar plunged as inflation eased.

The dollar index, which gauges its value against a basket of six major currencies, lost its ground and plunged more than 3% yesterday as the US inflationary pressures cooled. According to the US Bureau of Statistics, the Consumer Price Index (CPI) for October rose by 7.7%, less than the consensus forecast at 8.0%, mirroring that the US inflation continues to ease from the previous month’s reading of 8.2%. On the other than, the Core CPI, excluding the volatile food and energy costs, increased by 0.3% for the month, yet far lower than the consensus forecast of 0.5%. With such a backdrop, it showed that the Federal Reserve’s barrage of interest rate hikes is beginning to have its intended effect toward sky-high inflation. Following with that, the target rate probabilities for the 14 Dec Fed Meeting show a sharp rise on 50 basis points of a rate hike, from 56.8% to 90.2%. However, it is noteworthy to mention that the inflation rate still remains well-above by the Fed’s 2% target. As of writing, the dollar index dropped -2.31% to 108.00.

In the commodities market, the crude oil price increased by 0.62% to $86.60 per barrel as US inflation came below expectations, dragging down the cost of oil for the non-US buyer. Besides, the gold price went up by 0.10% to $1755.00 per troy ounce amid the cooler-than-expected CPI data yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 4.4% | 2.1% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Sep) | -1.6% | -0.4% | – |

| 15:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.4% | – |

Technical Analysis

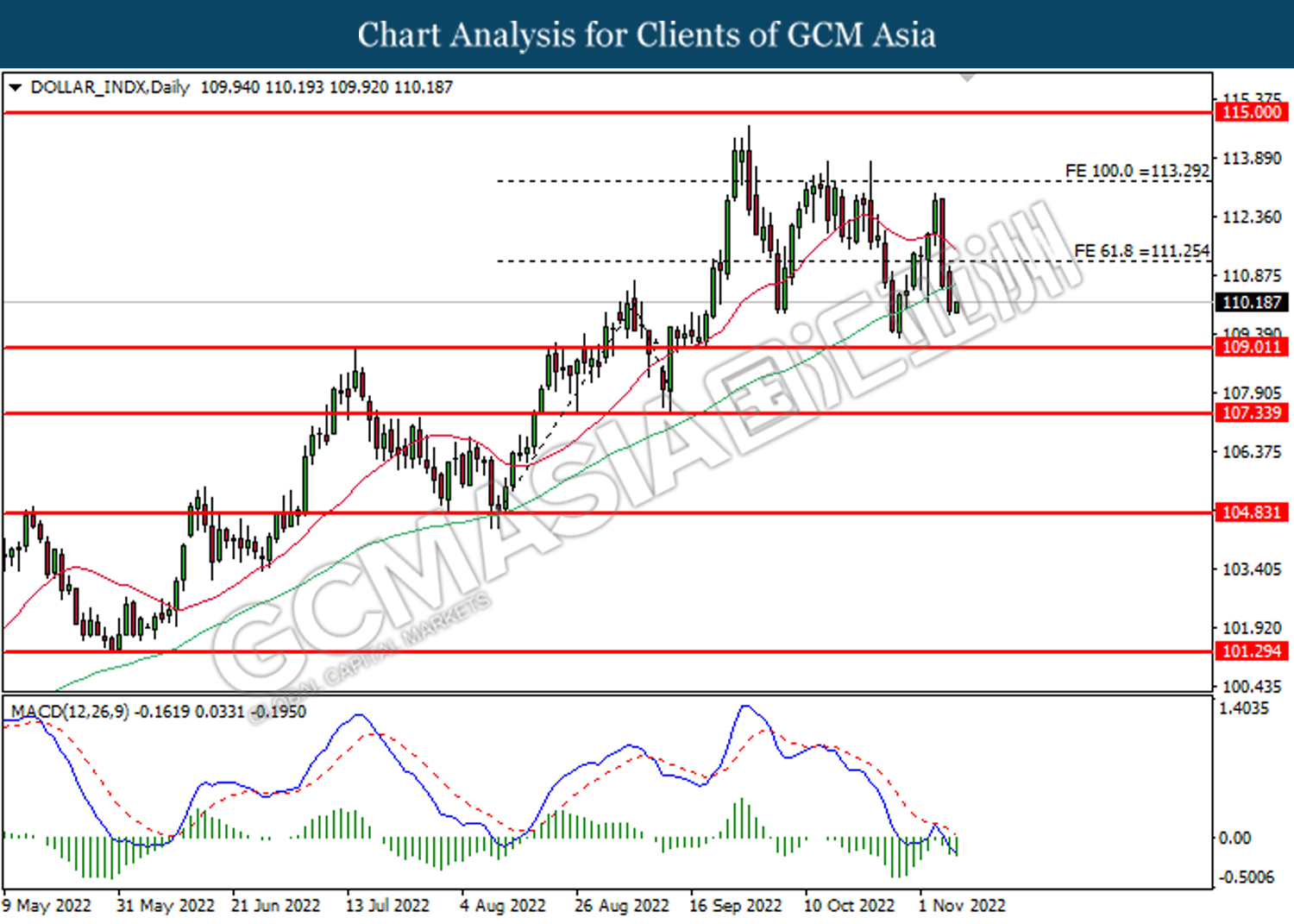

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 109.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 107.35.

Resistance level: 109.00, 111.25

Support level: 107.35, 104.85

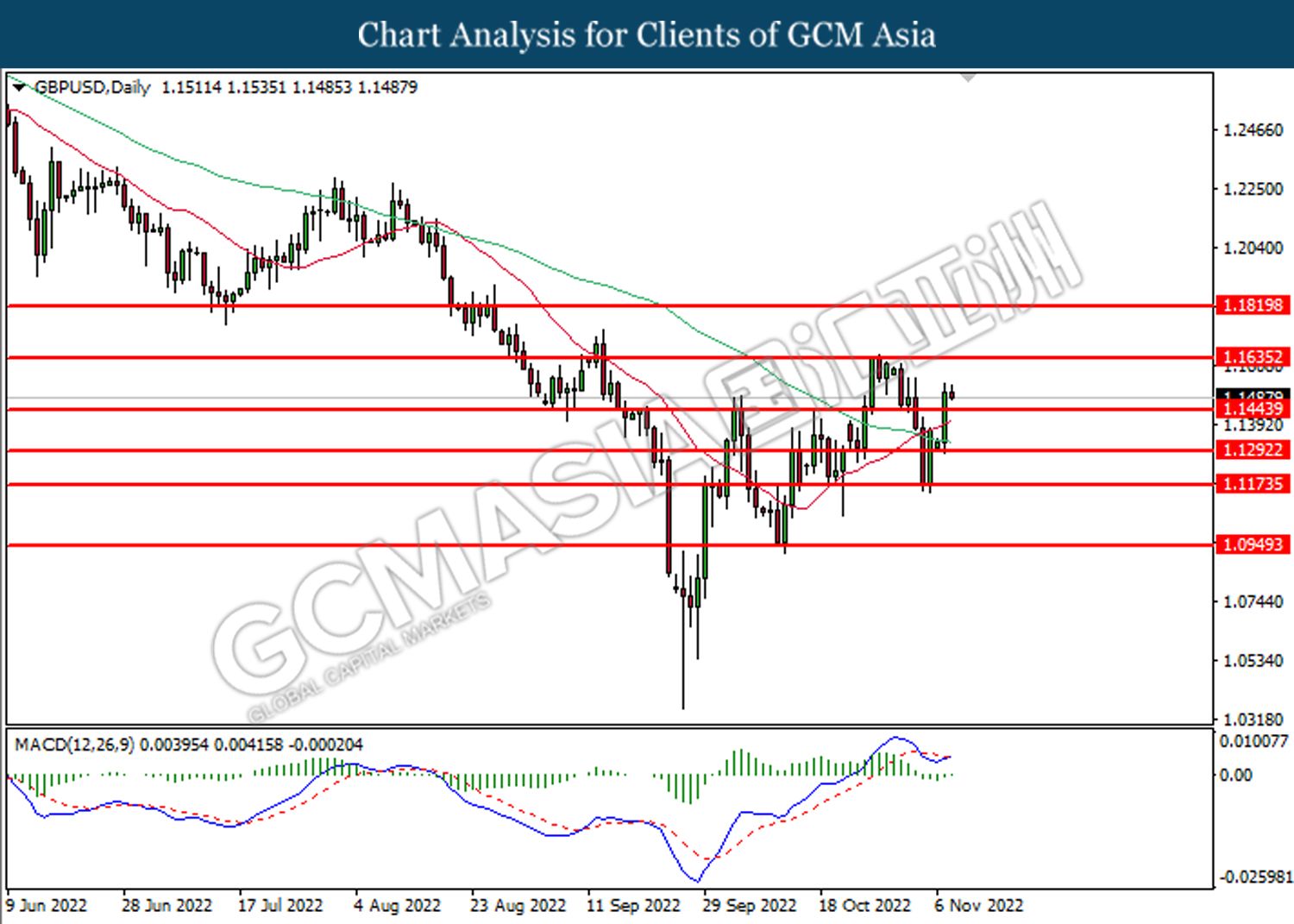

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1635. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1635, 1.1820

Support level: 1.1445, 1.1290

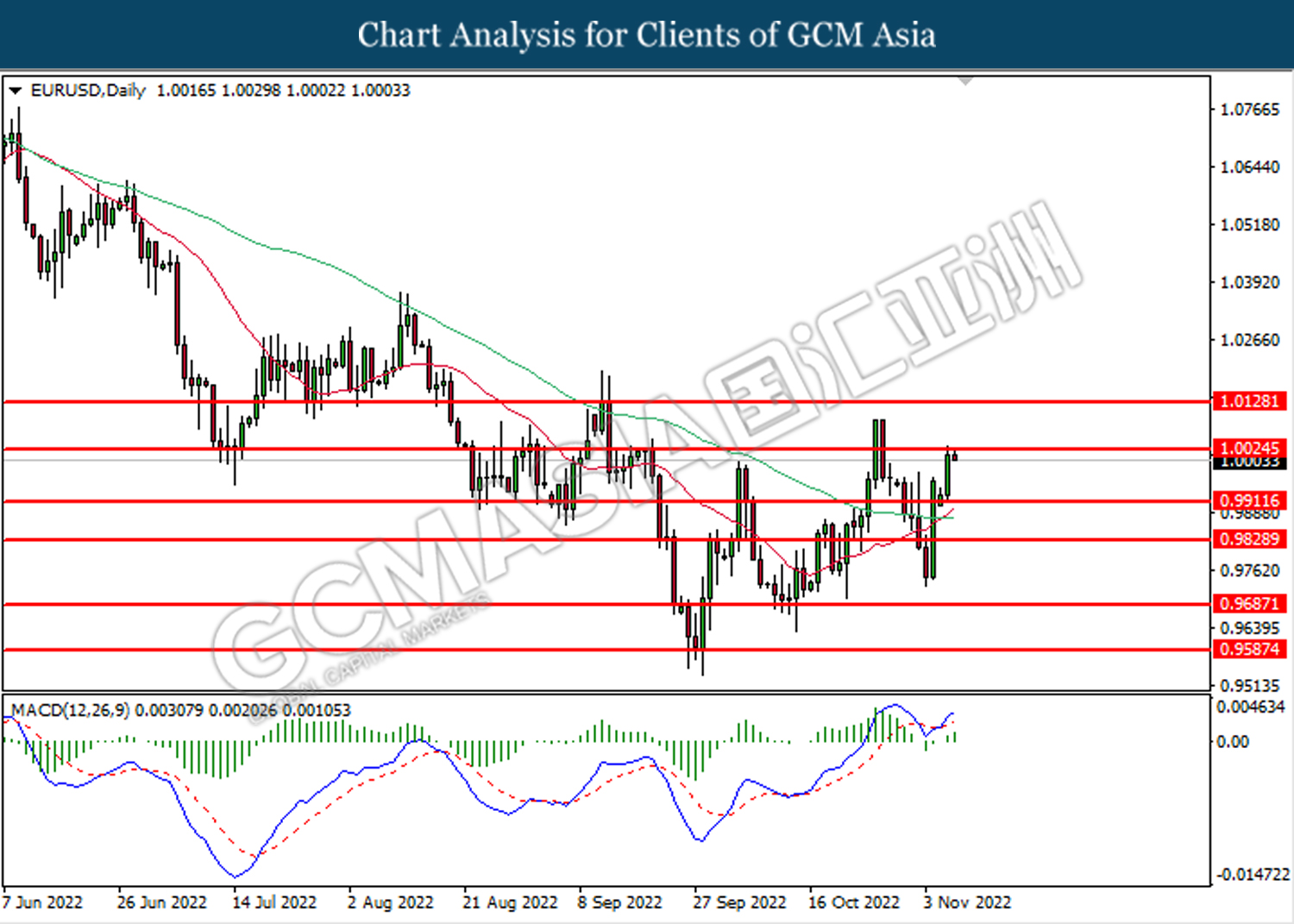

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0130. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0130, 1.0255

Support level: 1.0025, 0.9910

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.75. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 144.70, 147.30

Support level: 141.75, 138.90

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6530. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6640.

Resistance level: 0.6640, 0.6725

Support level: 0.6530, 0.6400

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6025. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6025, 0.6105

Support level: 0.5920, 0.5845

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9625. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9745, 0.9840

Support level: 0.9625, 0.9530

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 86.05. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 87.40, 88.80

Support level: 86.05, 84.35

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1726.15. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1766.50.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1695.35

101122 Afternoon Session Analysis

10 November 2022 Afternoon Session Analysis

Dollar lingered ahead of the long-awaited CPI.

The dollar index, which gauges its value against a basket of six major currencies, regained part of its luster yesterday while the market participants are embracing the closely-watched inflation figure. Later today, the US Bureau of Labor Statistics will announce its scheduled CPI data, whereby it would provide the market participants with a clear path of the Federal Reserve monetary policy. A strong price rise would likely reinforce the Federal Reserve’s hawkish rate hike plan, whereas a significant drop in inflation figure would further slowdown the pace of the rate hike going forward. On the other side, the ongoing mid-term election also boosted the appeal of the Greenback. At this point in time, the US Senate is still pending a run-off in Georgia state as neither of the candidates from the parties achieved a vote above 50%. On the other hand, the Republicans would likely regain control of the House of Representatives as the party is leading with more seats. However, the final result of the mid-term election is still subject to any changes as the counting of the vote is still going on.

In the commodities market, the crude oil price edged down by -0.05% to $85.75 per barrel as the Chinese Health Official insisted on maintaining their “Zero Covid” policy, in which could diminish the oil demand in the future. Besides, the gold price went up by 0.08% to $1708.05 per troy ounce amid the slight retracement in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Oct) | 0.6% | 0.5% | – |

| 21:30 | USD – CPI (YoY) (Oct) | 8.2% | 8.0% | – |

| 21:30 | USD – Initial Jobless Claims | 217K | 220K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 109.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 111.25.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1445. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1290.

Resistance level: 1.1445, 1.1635

Support level: 1.1290, 1.1175

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0025. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 1.0130, 1.0255

Support level: 1.0025, 0.9910

USDJPY, Daily: USDJPY was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 147.30.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.5845.

Resistance level: 0.5930, 0.6025

Support level: 0.5845, 0.5765

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3505. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3600.

Resistance level: 1.3600, 1.3715

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9840. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9930, 1.0055

Support level: 0.9840, 0.9745

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 86.05. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 84.35.

Resistance level: 86.05, 87.40

Support level: 84.35, 82.65

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1693.35. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1726.15.

Resistance level: 1726.15, 1766.50

Support level: 1693.35, 1661.40

101122 Morning Session Analysis

10 November 2022 Morning Session Analysis

US Dollar raised as aggressive rate hike path might be continued.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday following the aggressive rate hike path by Fed might be continued. According to Bloomberg, the CPI and Core CPI that excluding the food and energy prices had appeared a sign of dropping. Nonetheless, the overall CPI is seen rising from a month earlier by the most since June. With that, the Fed would likely to apply fifth consecutive 75 basis point rate hike in the upcoming meeting. Besides that, Richmond Fed President Thomas Barkin had reiterated on Wednesday that the necessary of hefty rate increase in order to restore price stability, which adding the odds that aggressive rate hike pace might be continued. As of now, the release of CPI data would highly catch the attention market participants. On the other hand, investors would also focus on the results of the US midterm election, as the control of the US House and Senate was still up in the air. As of writing, the Dollar Index appreciated by 0.72% to 110.33

In the commodities market, the crude oil price rose by 0.25% to $85.86 per barrel as of writing after a sharp decline throughout overnight trading session following the increase of crude oil inventories. According to EIA, the U.S. Crude Oil Inventories rose by 3.925M barrel, exceeding the market forecast of 1.360M barrel. In addition, the gold price depreciated by 0.05% to $1705.61 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Oct) | 0.6% | 0.5% | – |

| 21:30 | USD – CPI (YoY) (Oct) | 8.2% | 8.0% | – |

| 21:30 | USD – Initial Jobless Claims | 217K | 220K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0090, 1.0210

Support level: 0.9990, 0.9905

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5920, 0.6025

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9845, 0.9930

Support level: 0.9755, 0.9665

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.05, 89.25

Support level: 82.45, 79.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1725.65, 1756.05

Support level: 1699.70, 1677.85

091122 Afternoon Session Analysis

9 November 2022 Afternoon Session Analysis

Dollar dipped ahead of US mid term election result and CPI data.

The dollar index, which gauges its value against a basket of six major currencies, extends its losses to the 2-month low as the market participants expect the inflationary pressures to fall further for the month of October alongside the recent decline in energy prices. On Thursday night, the US government will bring traders the closely-watched Consumer Price Index (CPI) for October. Given the current concerns that inflation remains stubbornly high, the Federal Reserve has vowed to maintain its tightening monetary policy until the inflationary figures are controlled. With that, it further provides a signal to the investors that an inflation reading that is significantly below expectations would diminish the pace of the rate hikes by the Federal Reserve. Other than that, the market participants are also embracing the final result of the US mid-term election. A change of government in either Senate or House of Representatives would trigger market concern over the political uncertainty risk in the US. Therefore, investors are all eyeing the result of the mid-term election as well as the Thursday CPI data. As of writing, the dollar index dropped -0.06% to 109.60.

In the commodities market, the crude oil price edged down by -0.08% to $89.00 per barrel as the EIA institution slashed its forecast of global oil demand in the year 2023. Besides, the gold price dropped by -0.18% to $1709.40 per troy ounce following the rebound in the dollar index market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.115M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 109.00.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1445. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1635.

Resistance level: 1.1635, 1.1820

Support level: 1.1445, 1.1290

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0025. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0130.

Resistance level: 1.0130, 1.0255

Support level: 1.0025, 0.9910

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6530.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6025, 0.6105

Support level: 0.5930, 0.5845

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9840. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9930, 1.0055

Support level: 0.9840, 0.9745

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the trendline.

Resistance level: 88.75, 90.45

Support level: 87.40, 86.05

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1693.35. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1726.15.

Resistance level: 1726.15, 1766.50

Support level: 1693.35, 1661.40

091122 Morning Session Analysis

9 November 2022 Morning Session Analysis

US Dollar sinks as US midterm election begun.

The Dollar Index, which gauge its value against six major currencies slumped on yesterday over the US midterm election. The US midterm elections officially begun yesterday, while 35 Senate seats and all 435 House of Representatives seats are on the ballot. Currently, the Democratic Party is the governing party in the United States. However, according to Reuters, market participants are expecting Republicans to take back the House of Representatives and possibly win the Senate as well when results start rolling in Wednesday. If Republicans party succeed in retaking the House of Representative or even win the Senate, the Republicans will overturn the Democrats’ previous policy and legislation, which may lead to unstable political issue. As the possibility of unstable political issues heightened, investors are more willing to shift their capitals out of US market. As of now, investors would continue to scrutinize the latest updates with regards of the US midterm election results to anticipate the likelihood movement of the financial markets. As of writing, the Dollar Index dropped by 0.45% to 109.50

In the commodities market, the crude oil price depreciated by 0.15% to $88.78 per barrel as of writing over the rising of crude oil stocks. According to API, the US API Weekly Crude Oil Stock increased by 5.618M barrel, far higher than market forecast of 1.100M barrel increase. On the other hand, the gold price eased by 0.16% to $1713.00 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.115M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 109.95, 111.55

Support level: 108.45, 107.05

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0090, 1.0210

Support level: 0.9990, 0.9905

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6705

Support level: 0.6470, 0.6370

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6025, 0.6150

Support level: 0.5920, 0.5805

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9930, 1.0005

Support level: 0.9845, 0.9755

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.25, 92.50

Support level: 86.05, 82.45

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1725.65, 1756.05

Support level: 1699.70, 1677.85

081122 Afternoon Session Analysis

8 November 2022 Afternoon Session Analysis

Greenback stunned ahead of US mid-term election.

The dollar index, which gauges its value against a basket of six major currencies, hovered near the 10-day low as the market participants remain cautious against the US mid-term election. At this point in time, the Senate is currently evenly split between 50 Democrats and 50 Republicans. Despite that, vice president Kamala Harris has cast a tie-breaking vote for Democrats, where the Democrats currently have the slimmest majority in the Senate. In this time round, 35 out of 100 Senate seats are up for election, whereby 14 Democrats and 21 Republican seats will be elected in the mid-term election. With that, there is a high possibility that Republicans will take over the control of the Senate. On the other side, the House currently has 221 Democrats, 212 Republicans, and two vacancies. With the political uncertainty heightened, it is likely to boost the appeal of the safe haven currencies as well as safe haven commodities. As of writing, the dollar index rose 0.21% to 110.35.

In the commodities market, the crude oil price edged down by -0.50% to $91.95 per barrel as the Chinese Health Official vowed that they are not considering easing the Covid-19 restriction at this point in time. Besides, the gold price dropped by -0.30% to $1670.15 per troy ounce following the rebound in the dollar index market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 109.00.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1445. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1635.

Resistance level: 1.1635, 1.1820

Support level: 1.1445, 1.1290

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9910. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9910, 0.9830

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6530.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5930. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.5930, 0.6025

Support level: 0.5845, 0.5765

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9930. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9840.

Resistance level: 0.9930, 1.0055

Support level: 0.9840, 0.9745

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 93.20.

Resistance level: 93.20, 96.65

Support level: 89.45, 86.15

GOLD_, Daily: Gold price was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the trend line.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60

081122 Morning Session Analysis

8 November 2022 Morning Session Analysis

US Dollar beaten down over weak labor market.

The Dollar Index which traded against a basket of six major currencies extended its losses on yesterday over the sell-off sentiment caused by the fragile US labor market. Last week, the US Unemployment rate rose higher than the market expectations, which indicated that the current US labor market weakened. Thus, it reduced the odds of aggressive rate hike from Fed in the December meeting, as well as dragged down the appeal of US Dollar. In order to anticipate the interest rate decision from Fed, investors would continue to scrutinize the announcement of CPI data which scheduled on the upcoming Thursday. As of now, market participants would highly eye on the US midterm elections, as it related to the political stability of the US. Currently, Democratic and Republican, both parties’ supports are roughly tied and it might lead to political party rotation. As of writing, the Dollar Index depreciated by 0.66% to 110.04.

In the commodities market, the crude oil price rallied by 0.26% to $92.03 per barrel as of writing following the sanctions against Russia oil would likely to diminish the supply of oil. On the other hand, the gold price dipped by 0.12% to $1675.56 per troy ounce as of writing over the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0090, 1.0210

Support level: 0.9990, 0.9905

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6705

Support level: 0.6470, 0.6370

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6025, 0.6150

Support level: 0.5920, 0.5805

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9930, 1.0005

Support level: 0.9845, 0.9755

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 92.50, 95.45

Support level: 89.00, 86.05

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1677.85, 1699.70

Support level: 1655.60, 1633.35

071122 Afternoon Session Analysis

7 November 2022 Afternoon Session Analysis

Pound Sterling revived upon US labor market weakened.

The GBP/USD, which widely traded by majority of investors rebounded from its recent low on last Friday after the US Unemployment Rate had unexpectedly rose higher than market forecast, which hinted that the current US labor market remained fragile. Thus, it dialed down the market optimism toward economic progression in the US while prompting investors to flee away from the US currency market. Besides that, the gains experienced by Pound Sterling was extended amid the upbeat economic data from UK. According to Markit/CIPS, the UK Construction Purchasing Managers Index (PMI) in October has notched up from the previous reading of 52.3 to 53.2, exceeding the consensus expectation of 50.5. The higher-than-prior data has shown the expansion in the UK construction sector, which brought positive prospects toward UK economic outlook. At this juncture, the market participants would highly focus on the UK GDP data which scheduled on Friday as it can provide more views on upcoming BoE rate hike decisions. As of writing, GBP/USD eased by 0.40% to 1.1330.

In the commodities market, the crude oil price dropped by 1.37% to $91.31 per barrel as of writing after China government claimed that it would less likely to loosening its zero-Covid policy, which weighed down the market demand on oil. On the other hand, the gold price edged down by 0.01% to $1672.83 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:40 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9990, 1.0090

Support level: 0.9905, 0.9810

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 92.50, 95.45

Support level: 89.00, 86.05

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1677.85, 1699.70

Support level: 1655.60, 1633.35

071122 Morning Session Analysis

7 November 2022 Morning Session Analysis

Greenback slumped following the release of mixed labor data.

The dollar index, which gauges its value against a basket of six major currencies, plunged as the US labor market showed a mixed result last Friday. According to the Bureau of Labor Statistics, the US Nonfarm Payrolls came in at 261K, stronger than the consensus forecast at 200K, showing that huge job creation is happening in the world’s largest economy. However, the market optimism was pared off after the market participants digested the jobs report and paid more attention to the unemployment rate data. Surprisingly, the unemployment rate in the US rose to 3.7% from September’s 3.5%, suggesting some sign of loosening in the US labor market. With these backdrops, the investors took it negatively while recking that the Federal Reserve shift toward a conservative rate hike path, whereby a smaller interest rate increase would happen in December. As of writing, the dollar index dropped 1.90% to 110.80.

In the commodities market, the crude oil price edged up by 0.10% to $92.55 per barrel as the G7 allies’ sanctions on Russian oil go into effect in almost a month, which is largely expected to curtail Russia’s oil exports. Besides, the gold price rose by 0.05% to $1681.15 per troy ounce amid the dollar’s weakening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:40 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 109.00.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1290. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1445, 1.1635

Support level: 1.1290, 1.1175

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9910. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9910, 0.9830

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6530.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5845. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5930.

Resistance level: 0.5930, 0.6025

Support level: 0.5845, 0.5765

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3505. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3505.

Resistance level: 1.3600, 1.3715

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9930. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 93.20.

Resistance level: 93.20, 96.65

Support level: 89.45, 86.15

GOLD_, Daily: Gold price was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the trend line.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60

041122 Afternoon Session Analysis

4 November 2022 Afternoon Session Analysis

Pound slumped as the economic outlook ‘remains challenging’.

The Pound Sterling, which is widely traded by global investors, lost its ground yesterday as the Bank of England (BoE) gave a dovish stance regarding the UK economic outlook. In the meeting, BoE raised interest rates to 3% from 2.25%, its biggest rate rise since 1989. Besides, the central bank forecasts inflation will hit a 40-year high of around 11% during the current quarter, but that Britain has already entered a recession that could potentially last two years – longer than during the 2008-09 financial crisis. With such a pessimistic view, the pound sold off by the market participants tremendously despite a 75-basis point of rate hike. Moreover, the fundamental problems facing the British economy remain. In September, the consumer price inflation returned to a 40-year high of 10.1%, and is likely to have risen further last month as the energy prices in UK rose. On the other side, the new UK government is still restructuring their long-term plan to calm down the market uncertainty as well as regaining the confidence of the residents. As of writing, the pair of GBP/USD rose 0.39% to 1.1210.

In the commodities market, the crude oil price edged up by 1.03% to $88.90 per barrel as the drop in dollar index value urged the crude oil to regain the luster. Besides, the gold price rose by 0.55% to $1638.25 per troy ounce following the slight retracement in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Oct) | 52.3 | 48.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Oct) | 263K | 200K | – |

| 20:30 | USD – Unemployment Rate (Oct) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Oct) | 21.1K | 5.0K | – |

| 22:00 | CAD – Ivey PMI (Oct) | 59.5 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1175. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1290, 1.1445

Support level: 1.1175, 1.0950

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 147.30. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6285. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6400, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5765. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5845.

Resistance level: 0.5845, 0.5905

Support level: 0.5765, 0.5710

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3715. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3875.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 1.0055. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0155, 1.0235

Support level: 1.0055, 0.9930

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded lower while testing near the support level at 1627.60. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00