041122 Morning Session Analysis

4 November 2022 Morning Session Analysis

US Dollar bulls continued upon aggressive rate hike expectations.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday, which leading by the hawkish statement from Fed. In the early Thursday, Federal Reserve Chairman Jerome Powell signaled that the US interest rates would likely to peak at a higher level than markets expected, causing the US 10-Year Treasury Yield to surge. Yesterday, the treasury yield rose as high as 4.189%, leading the investors to shift their capitals toward US Dollar. On the economic data front, the upbeat employment data has extended the gains of Dollar Index. According to the US Department of Labor, the US Initial Jobless Claims notched down from the previous reading of 218K to 217K, missing the consensus forecast of 220K. The lower-than-prior figure of the data has shown that the diminishing of unemployment rate, while it provide a positive economic outlook for the US economy. As of now, market participants would highly eye on the announcement of crucial employment data —- the US Nonfarm Payrolls and Unemployment Rate in order to gauge the likelihood movement of US Dollar. As of writing, the Dollar Index edged down by 0.06% to 112.79.

In the commodities market, the crude oil price depreciated by 0.31% to $87.85 per barrel as of writing, as the rate hike from Fed and BoE would likely to weigh down the market demand for oil. On the other hand, the gold price appreciated by 0.17% to $1631.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Oct) | 52.3 | 48.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Oct) | 263K | 200K | – |

| 20:30 | USD – Unemployment Rate (Oct) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Oct) | 21.1K | 5.0K | – |

| 22:00 | CAD – Ivey PMI (Oct) | 59.5 | – | – |

Technical Analysis

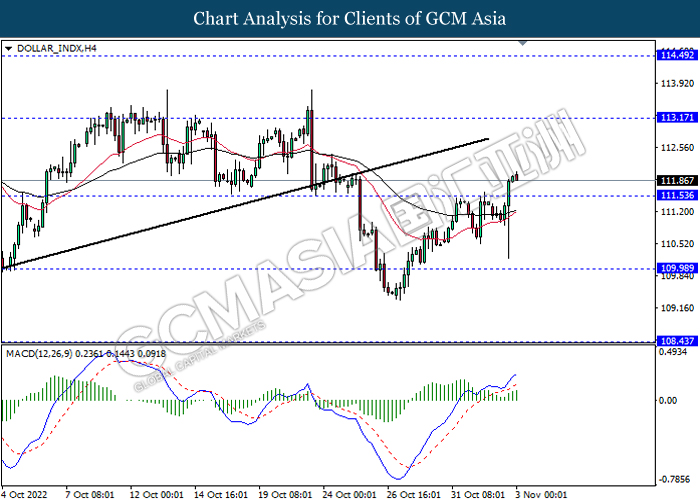

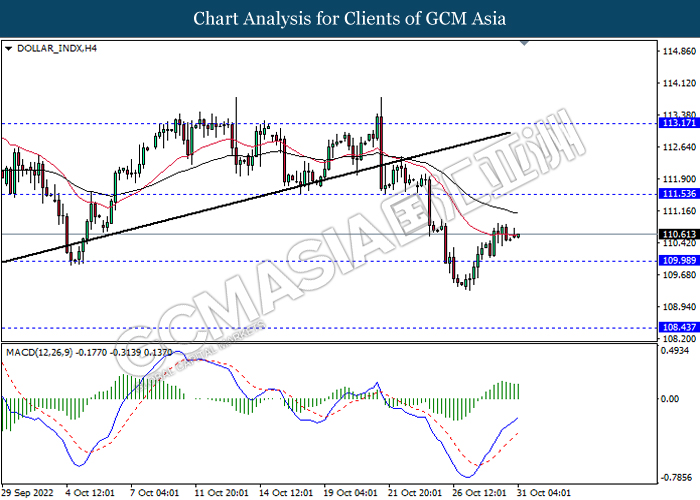

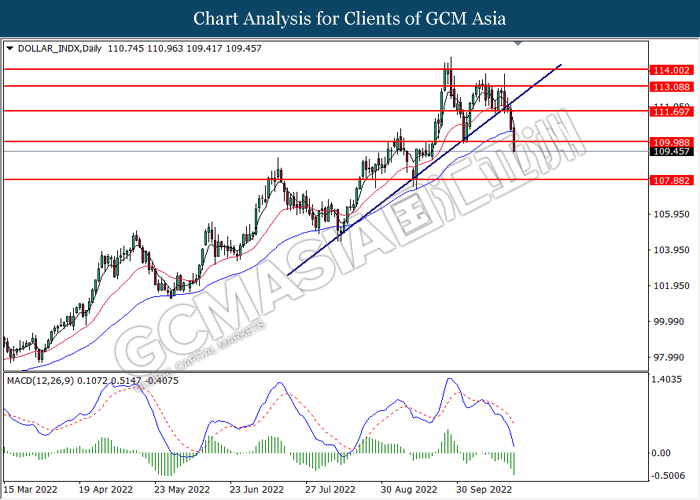

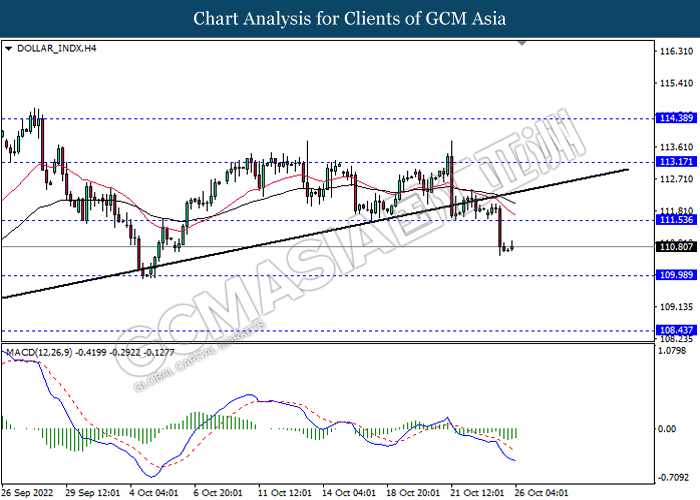

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 113.15, 114.50

Support level: 111.55, 109.95

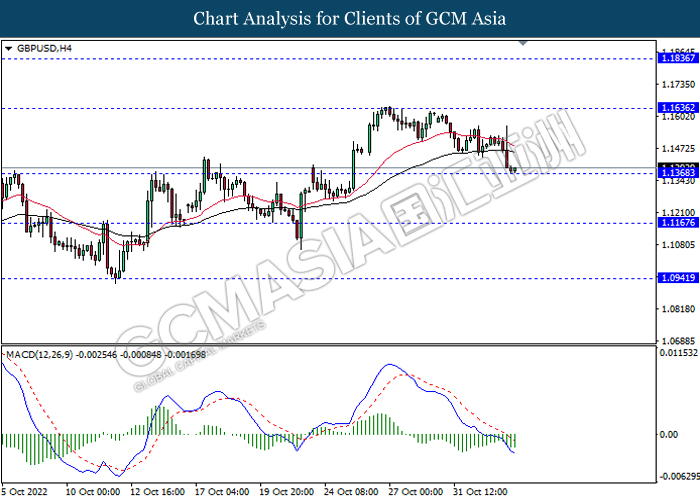

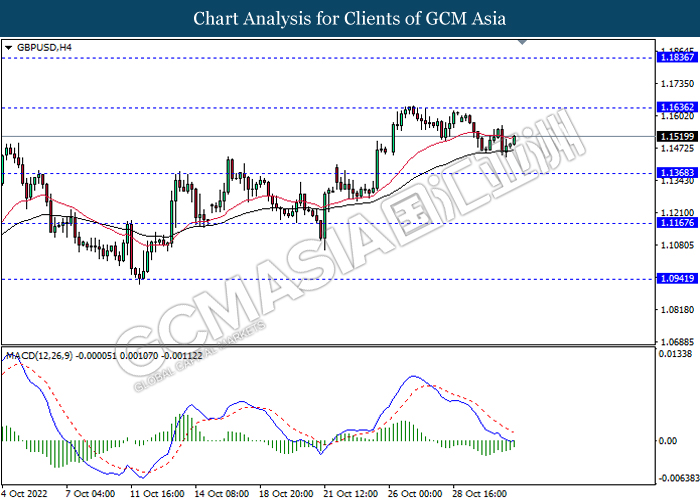

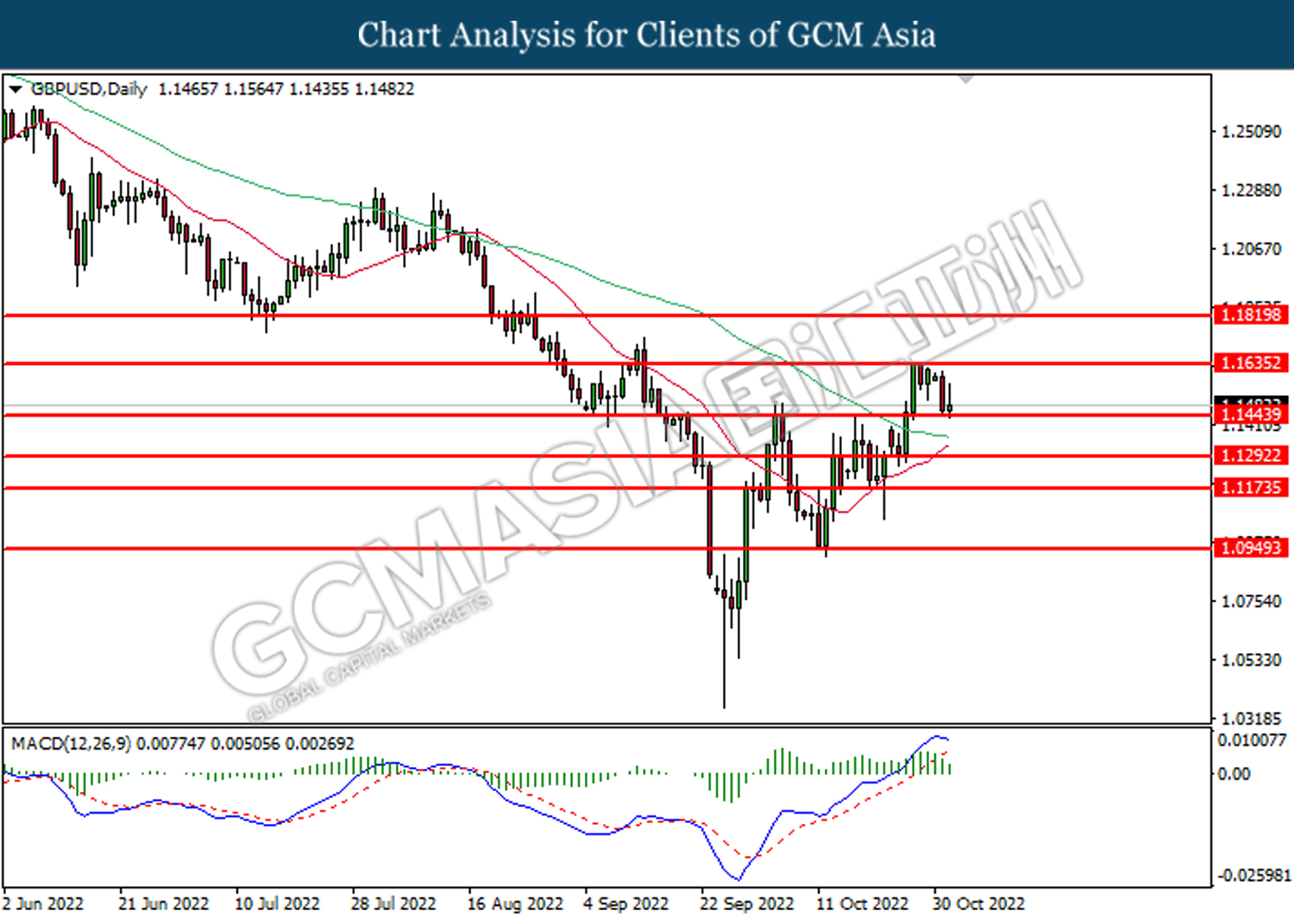

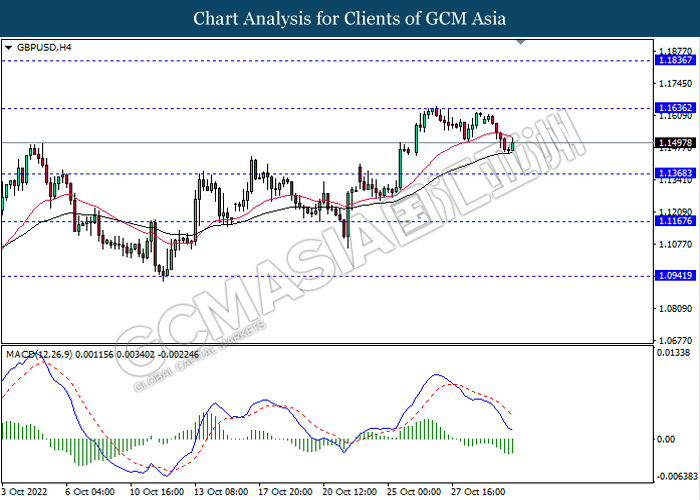

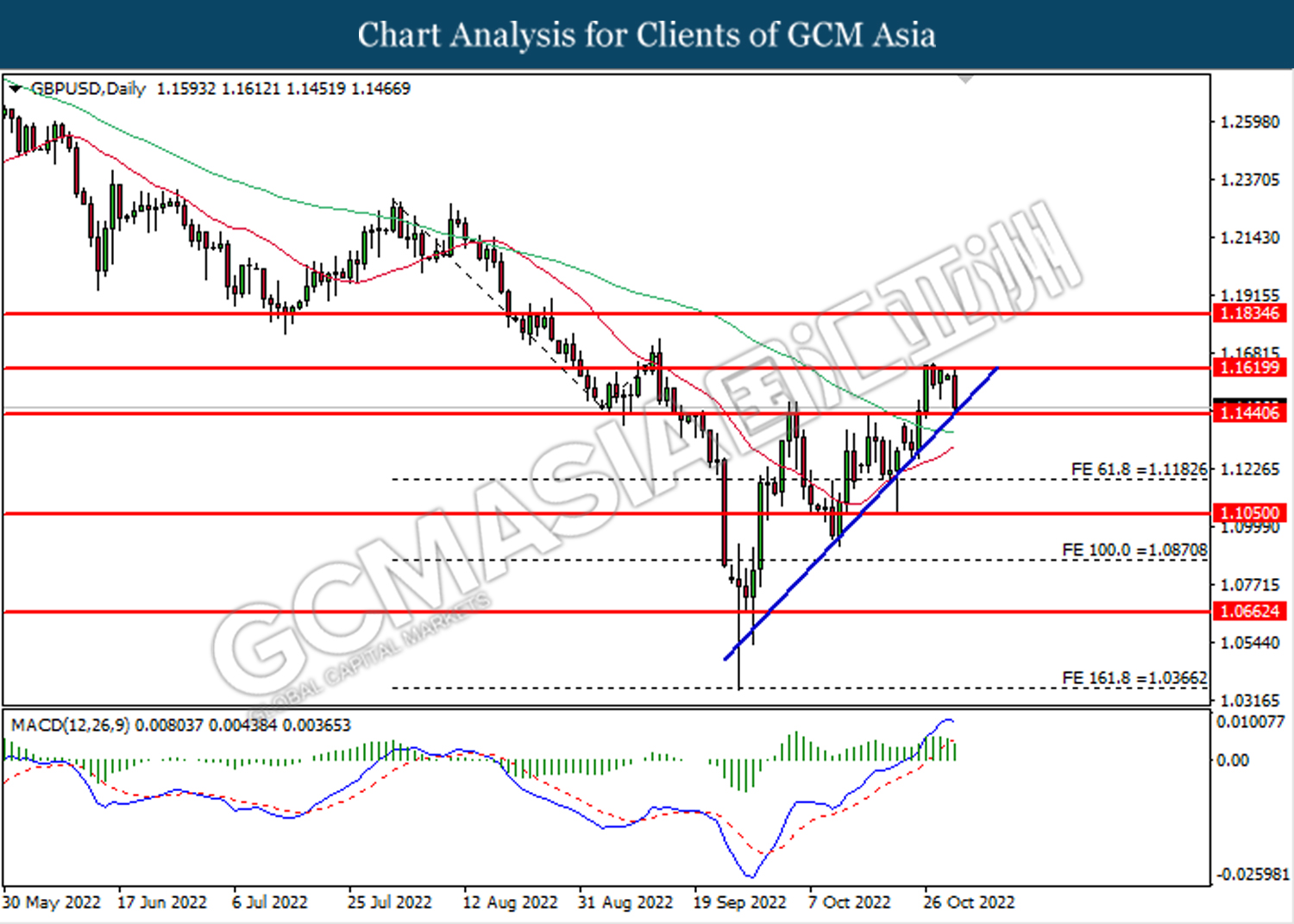

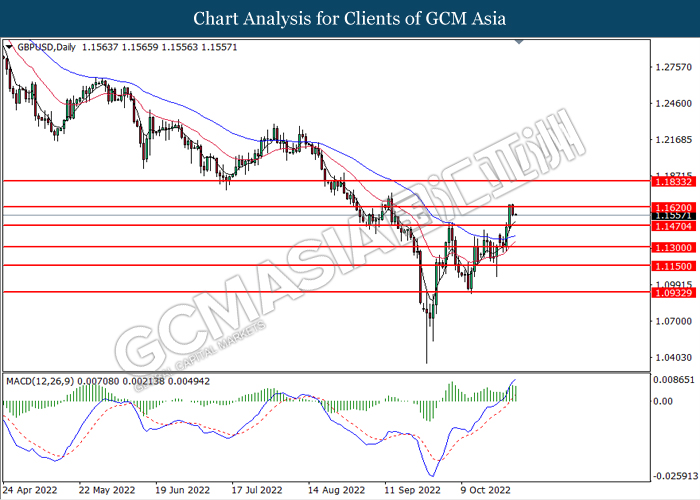

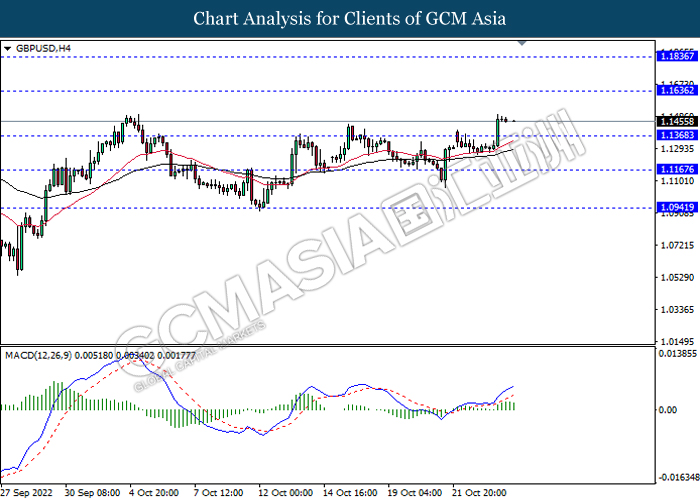

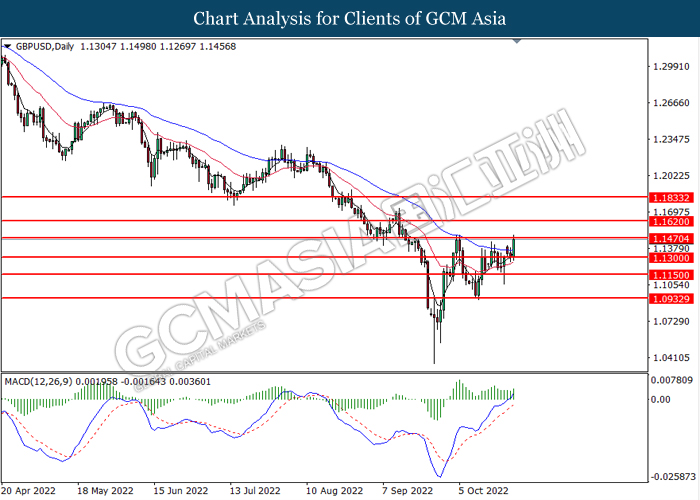

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

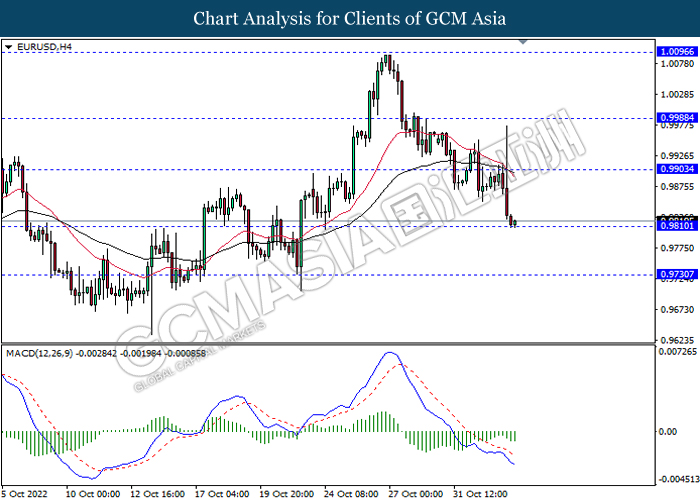

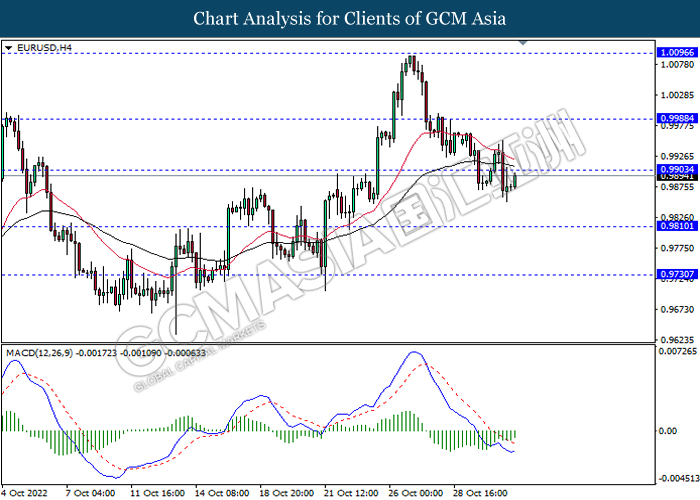

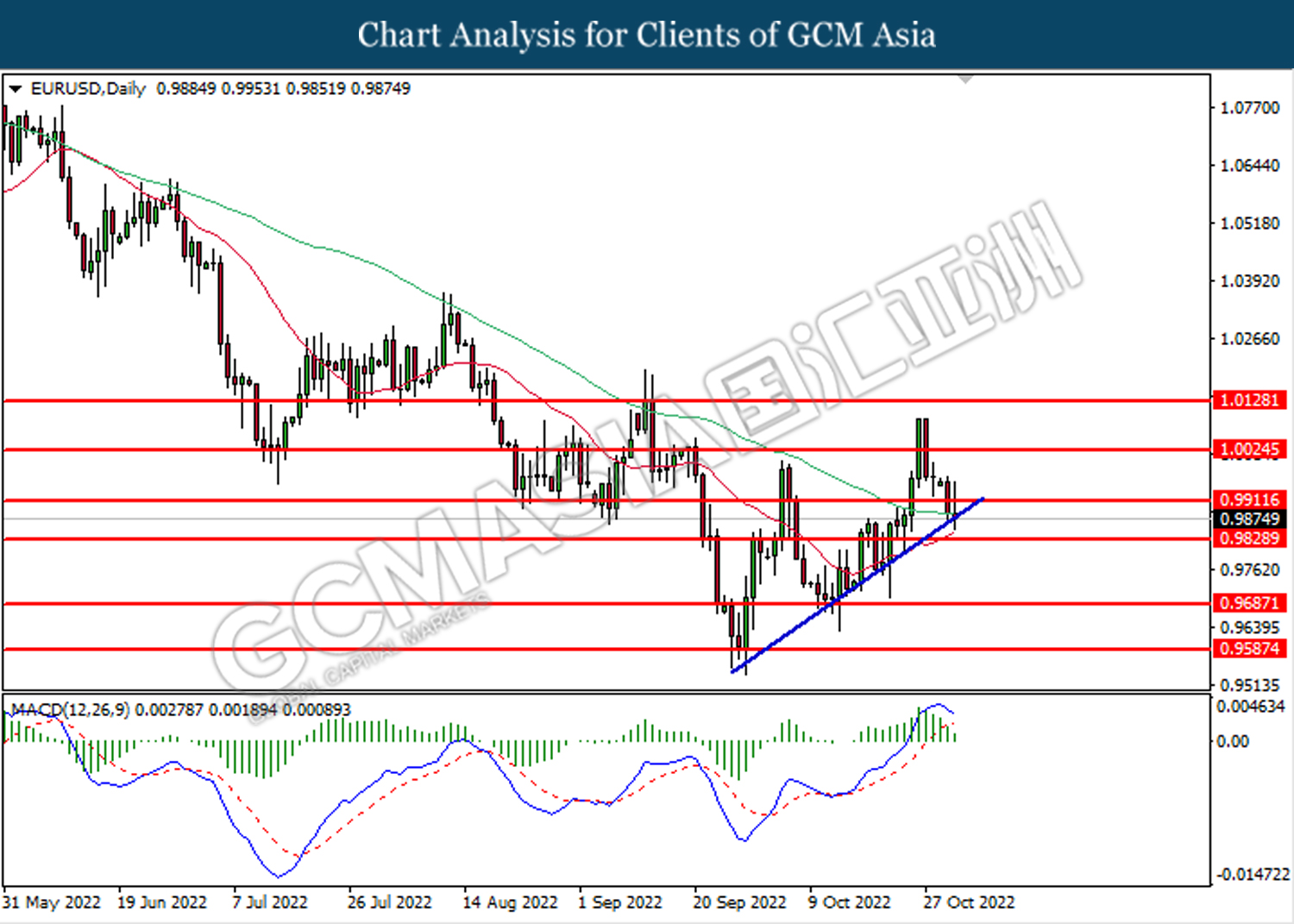

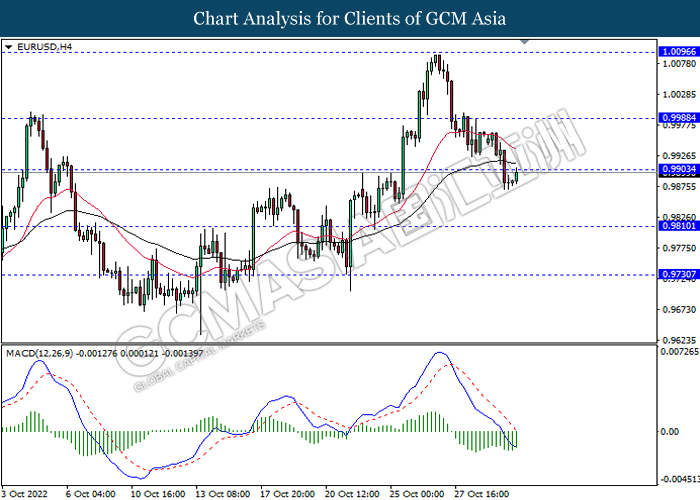

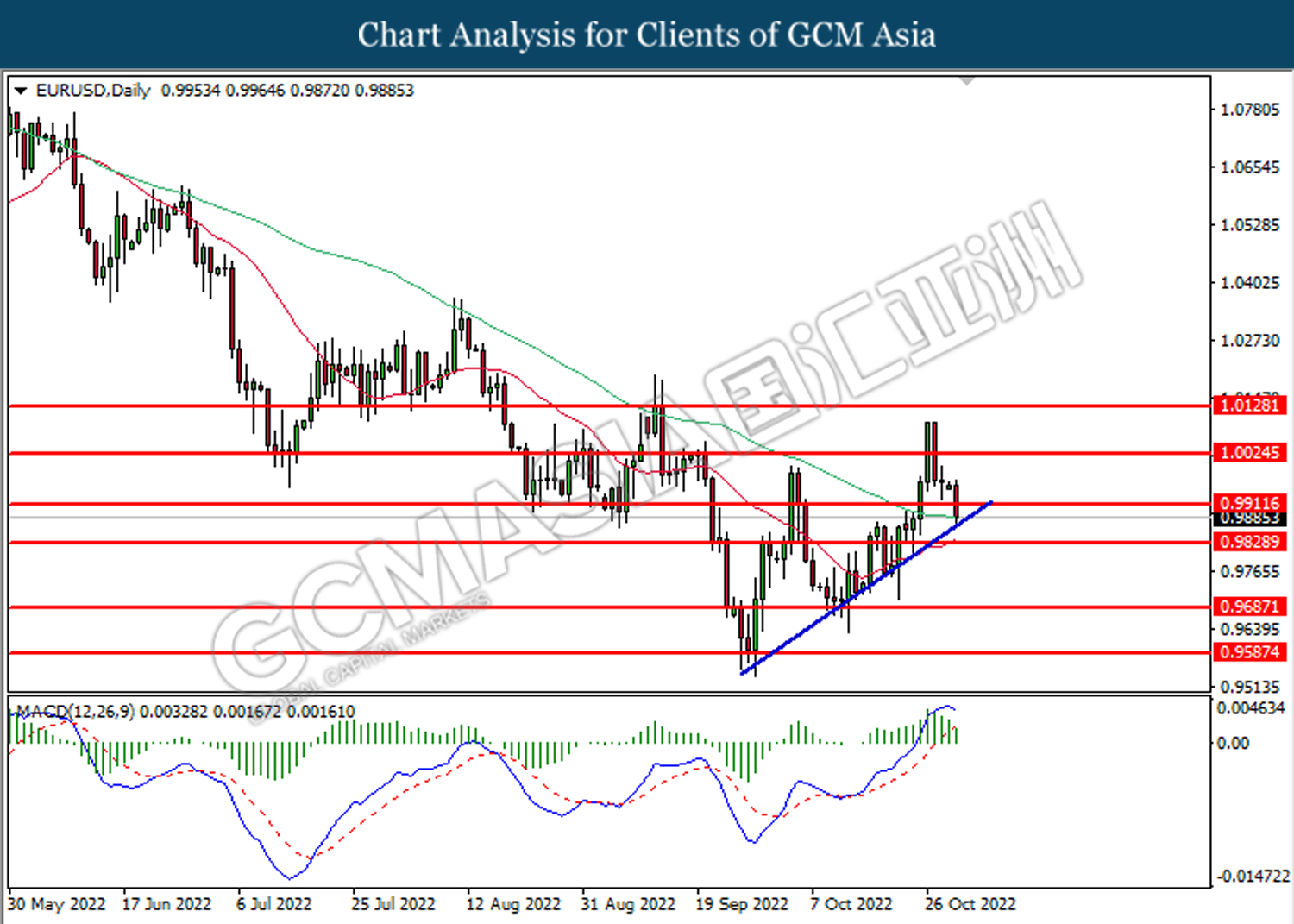

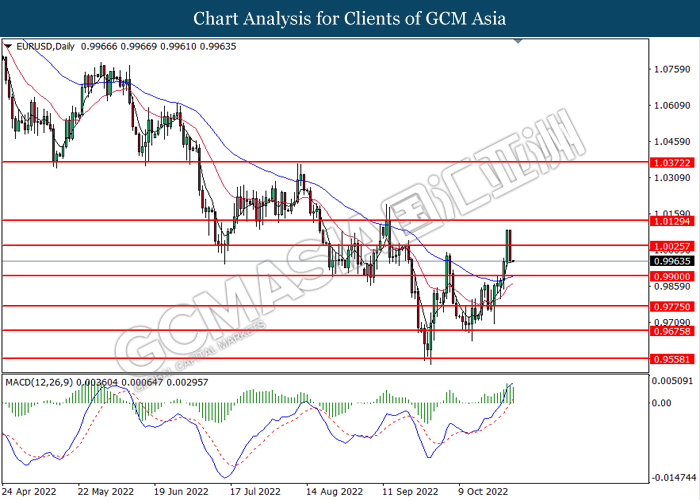

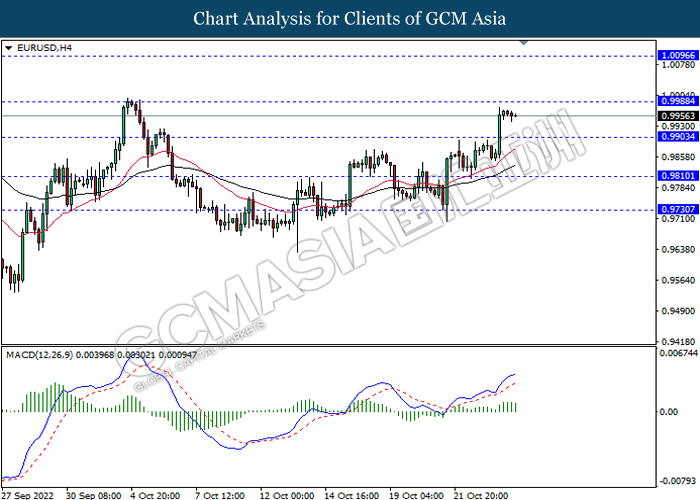

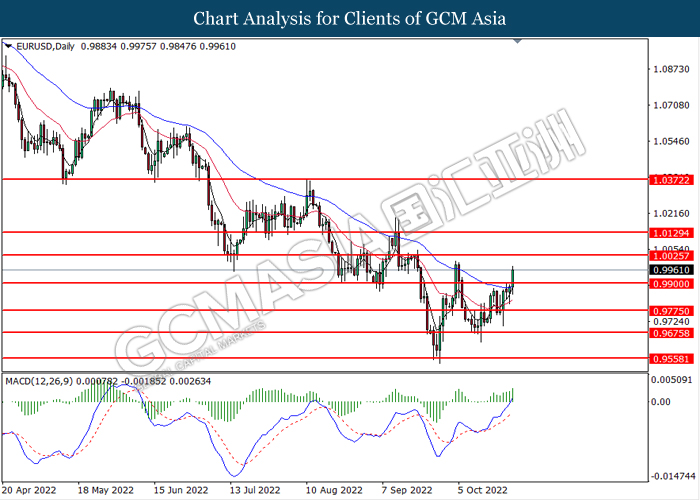

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9650

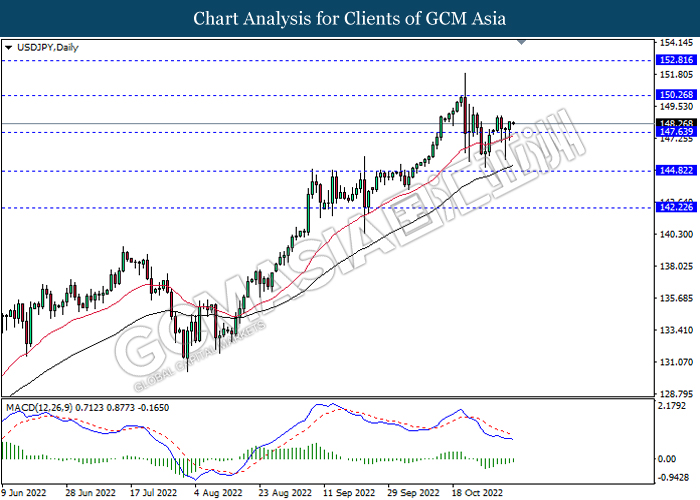

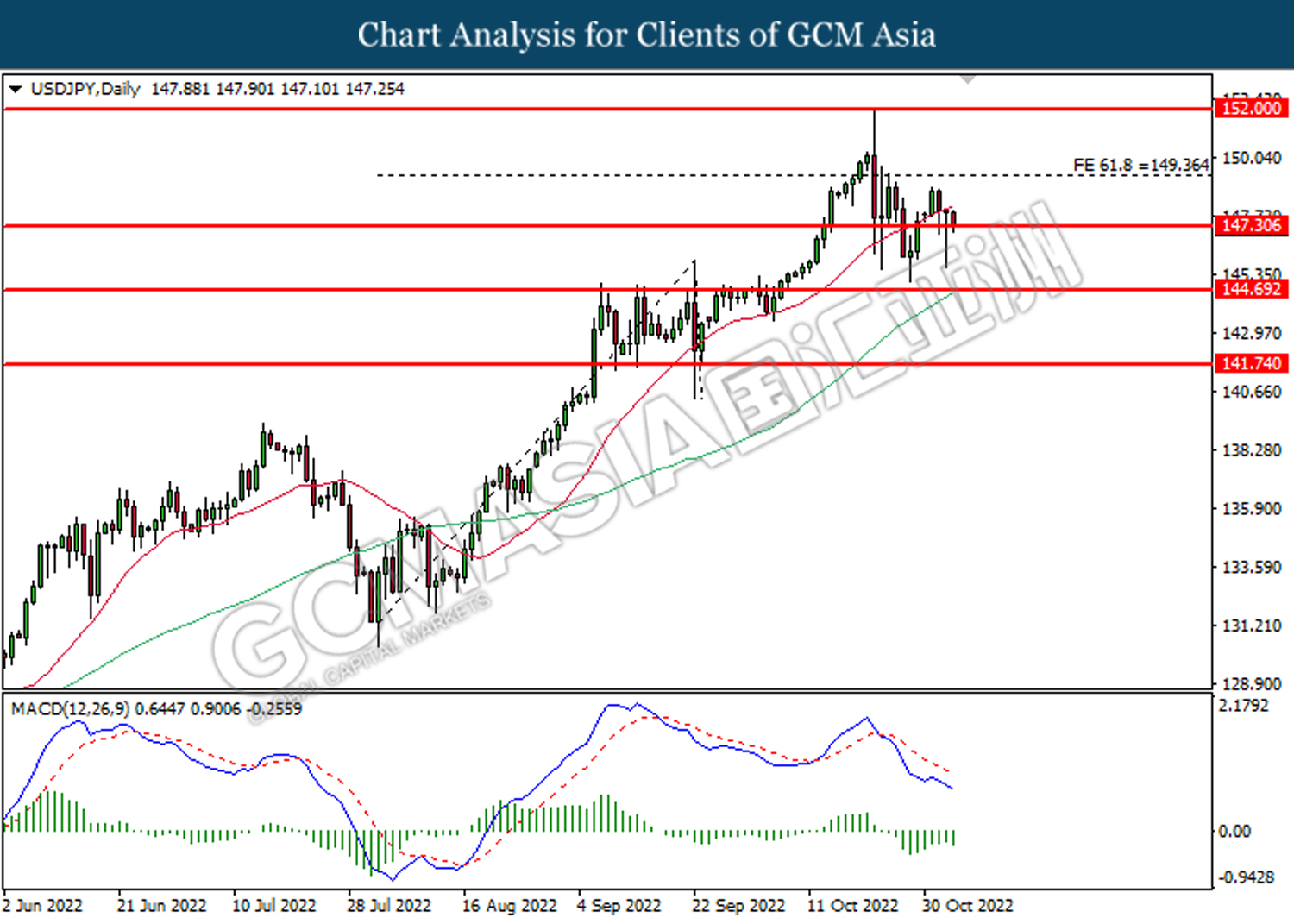

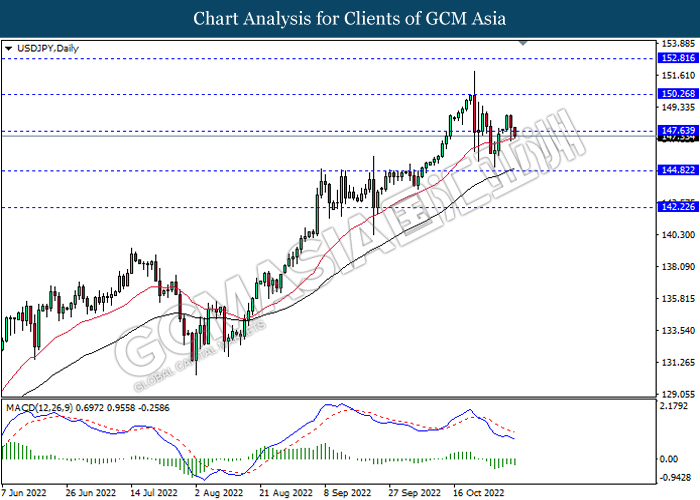

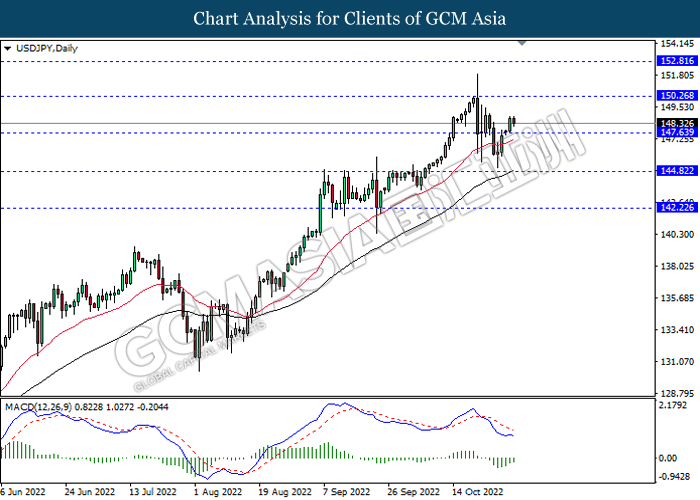

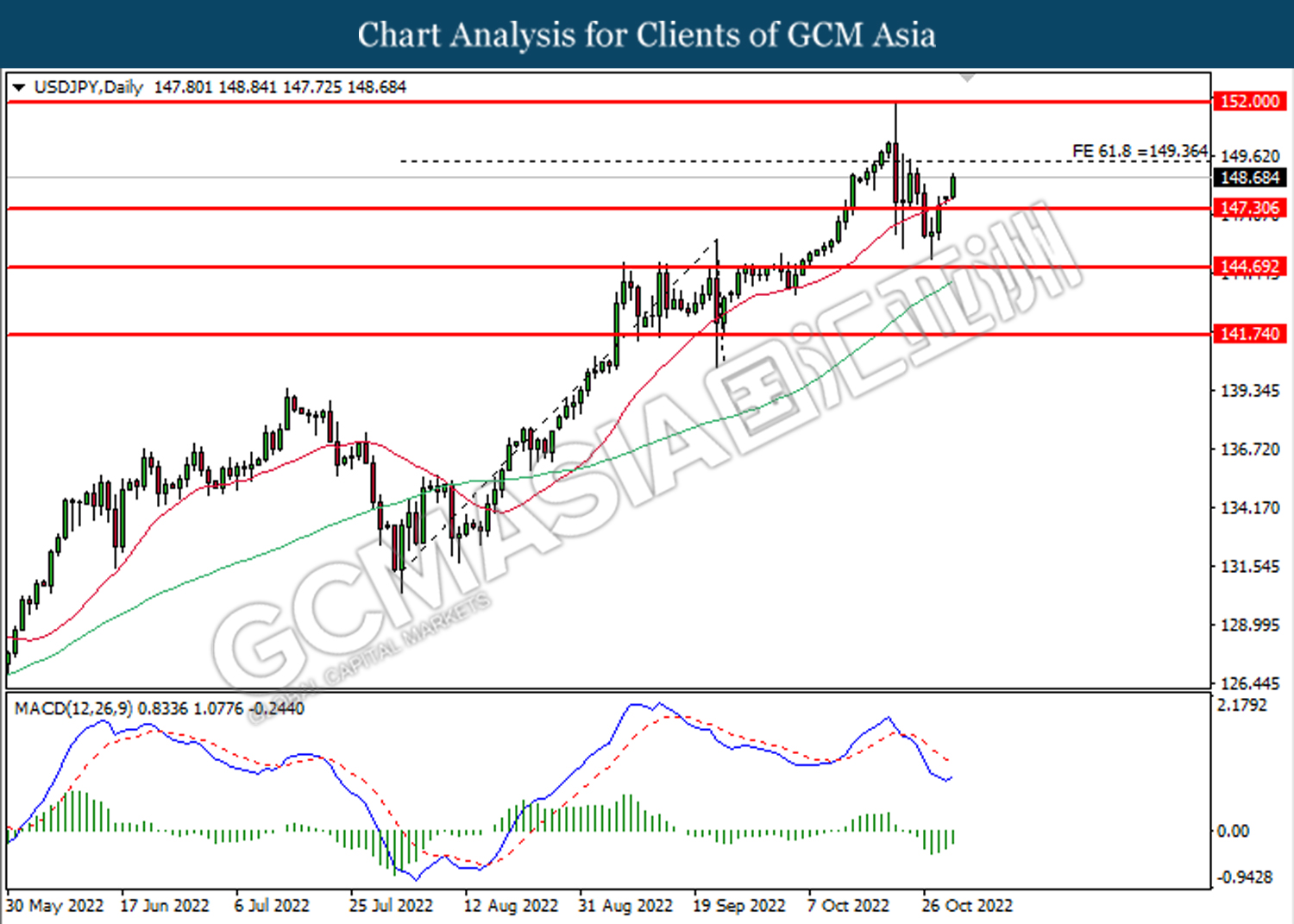

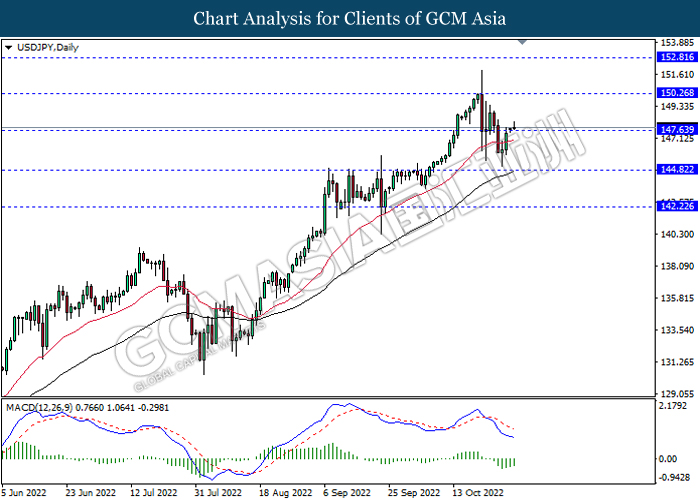

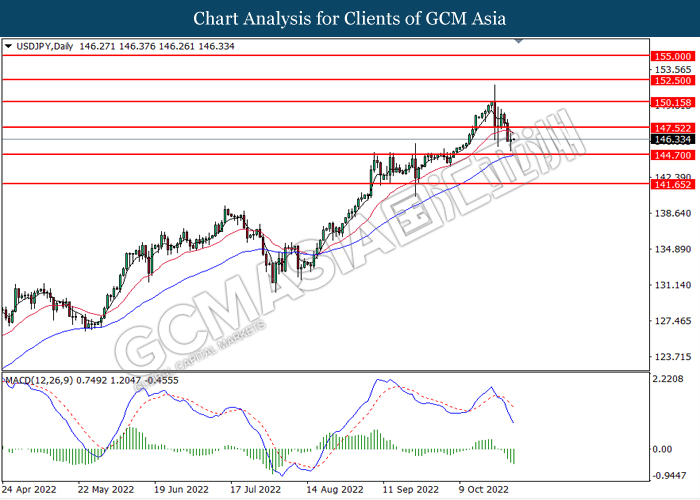

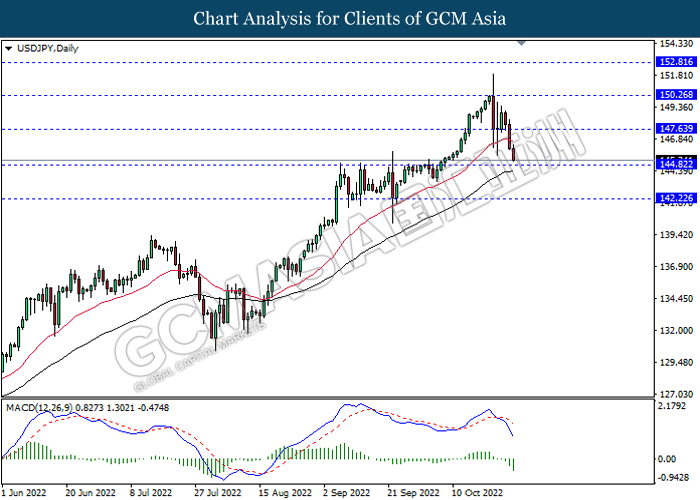

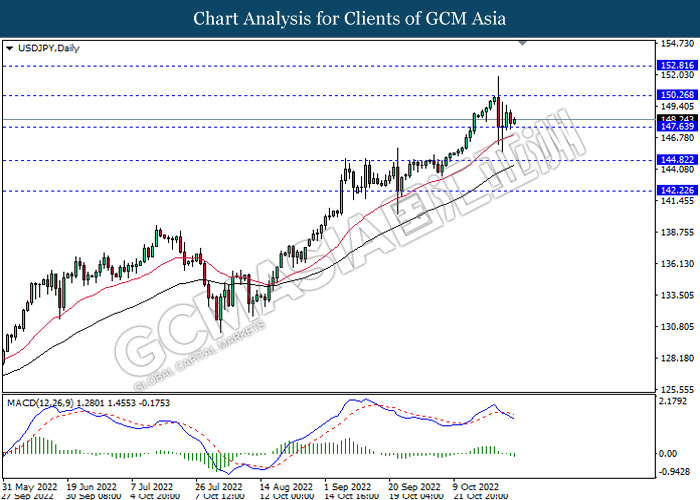

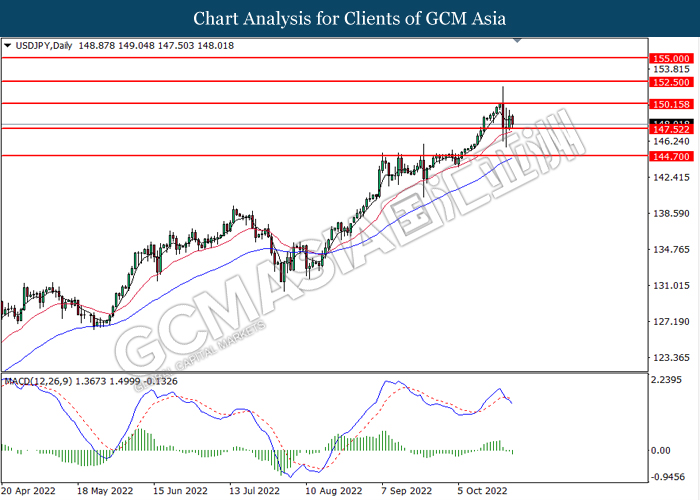

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

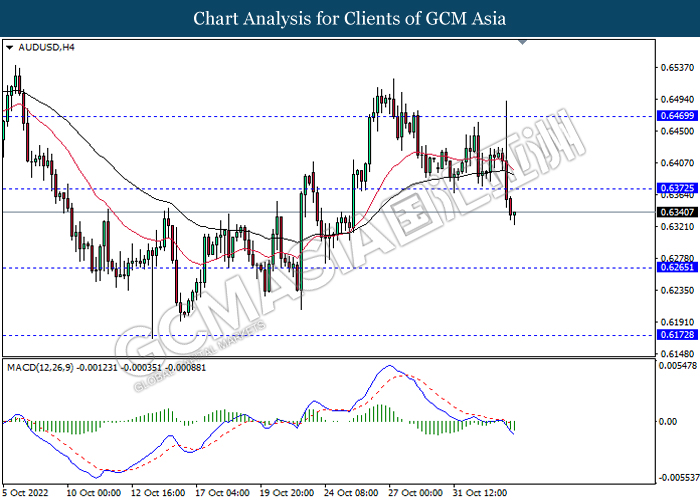

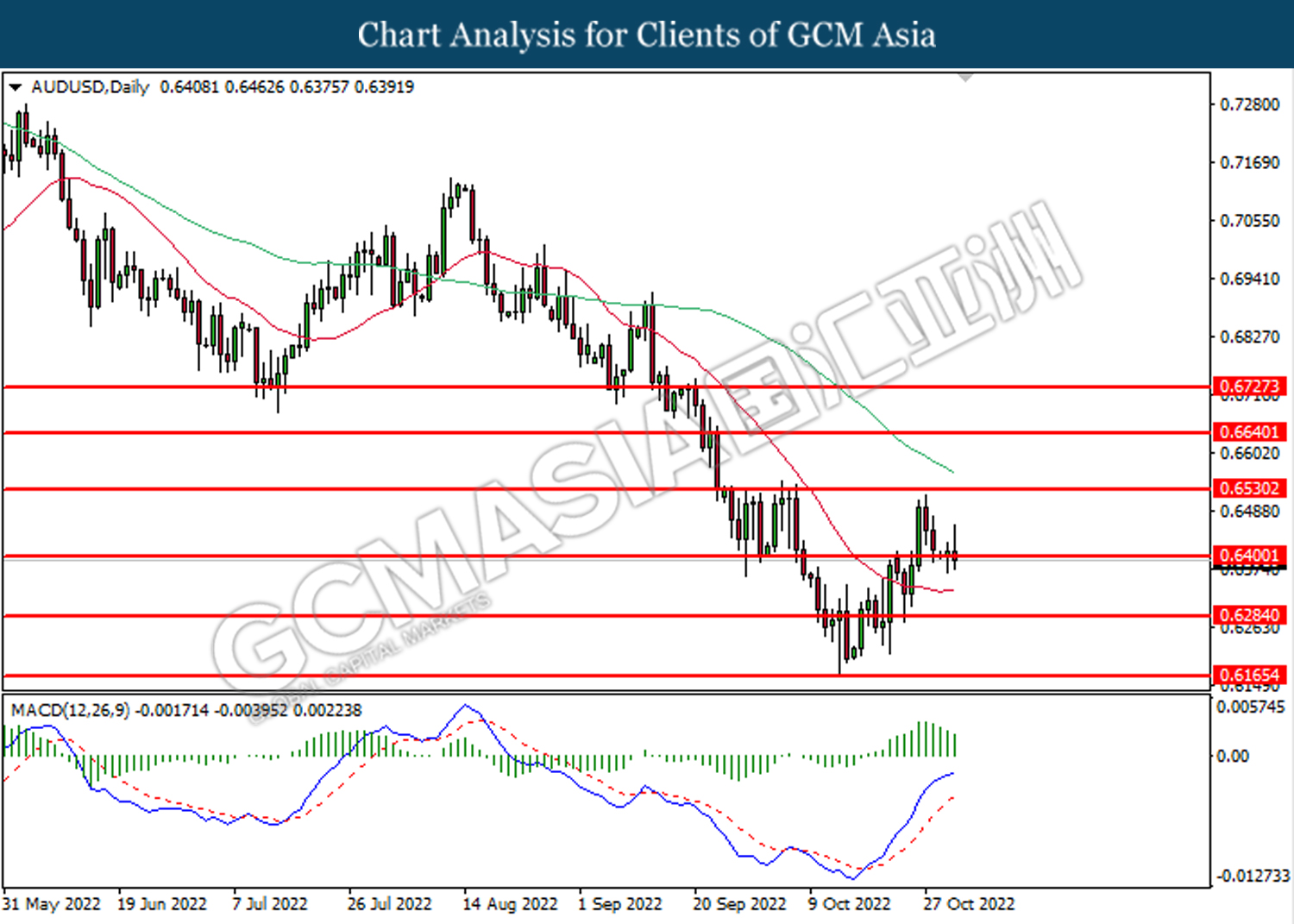

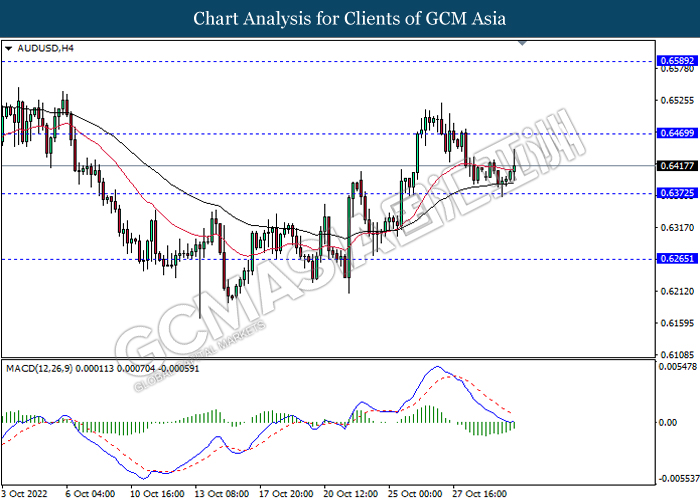

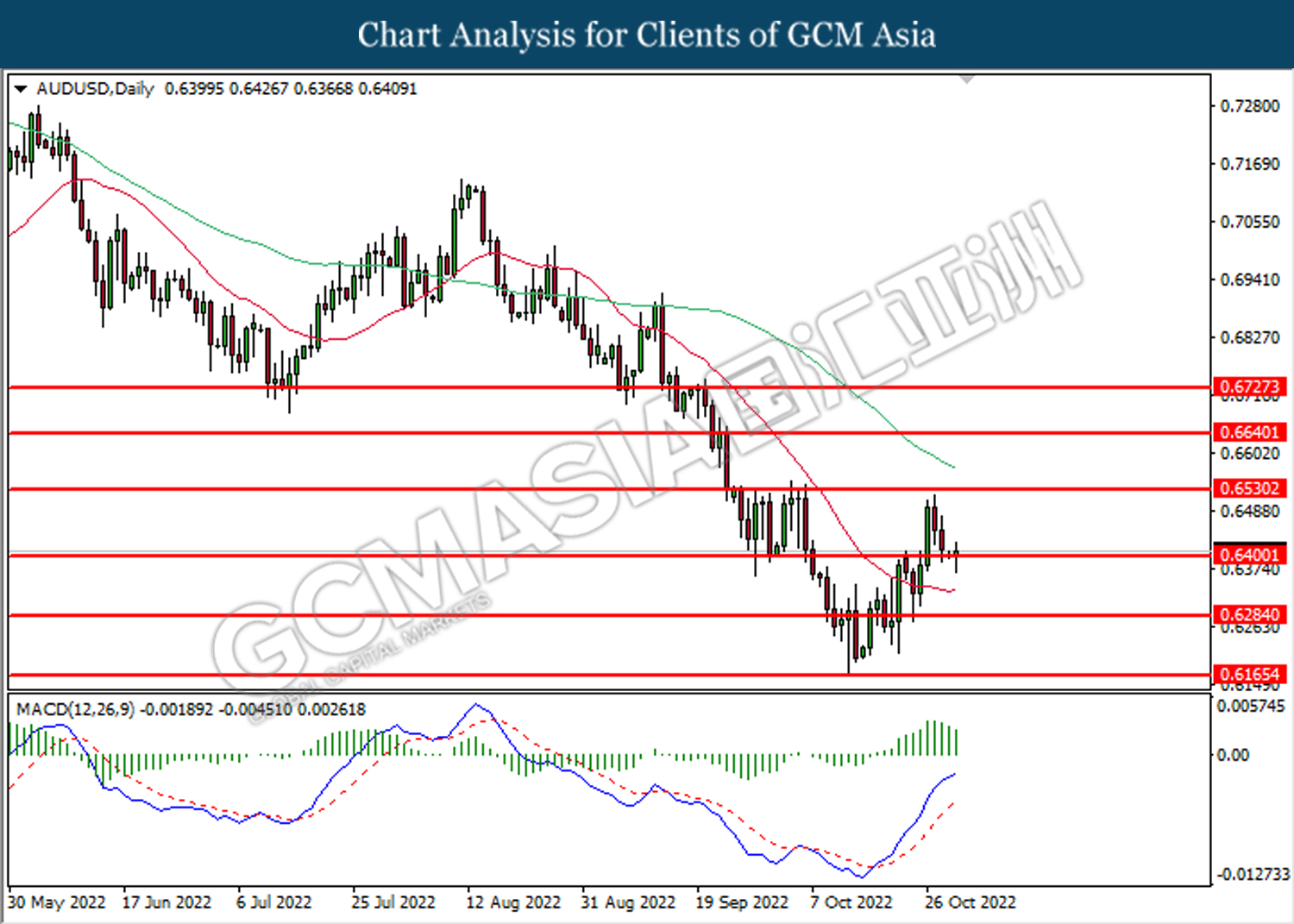

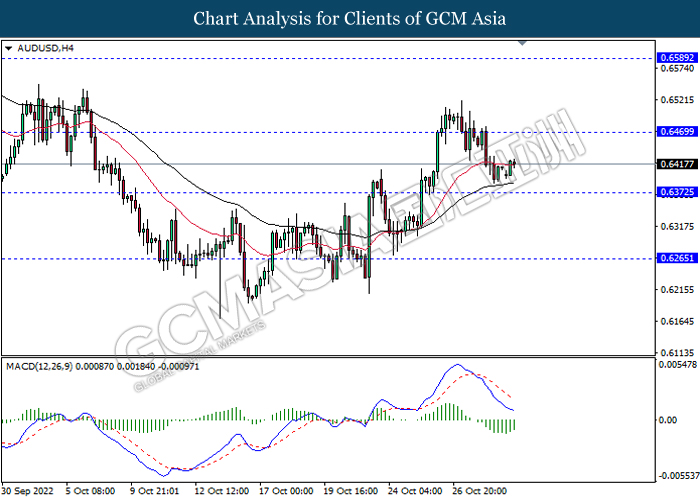

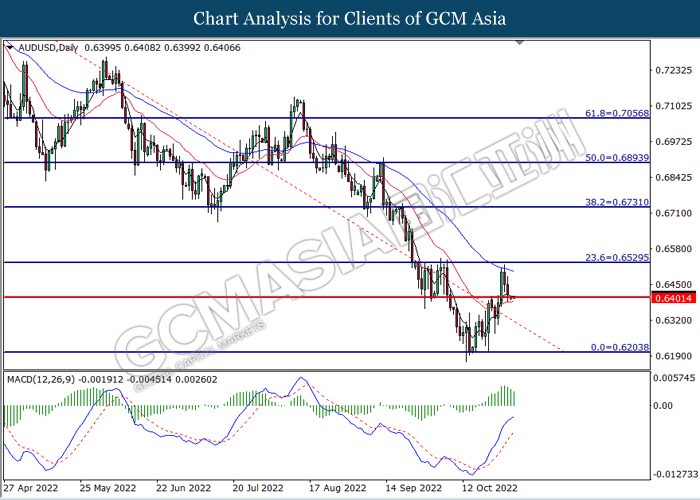

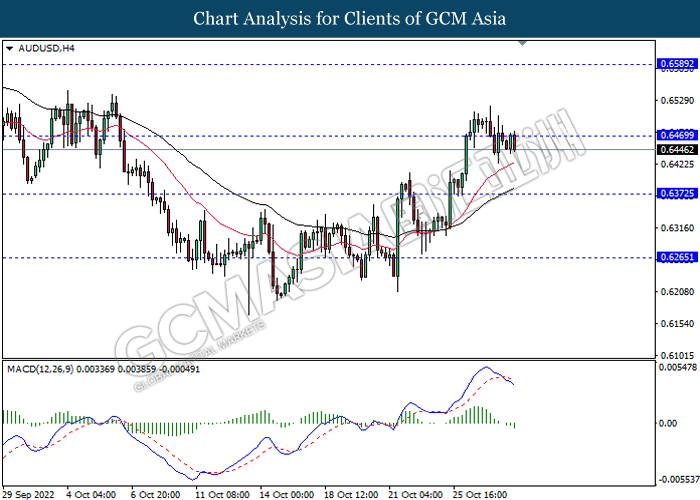

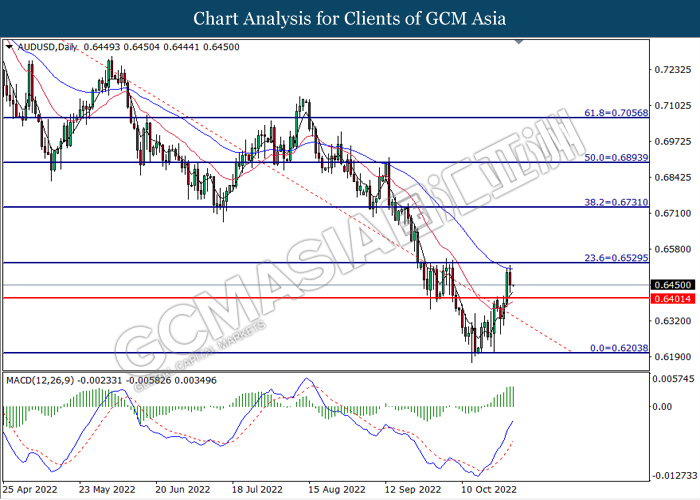

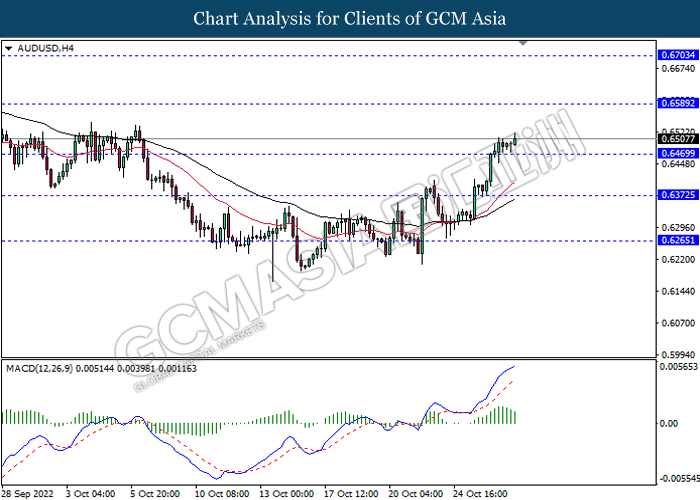

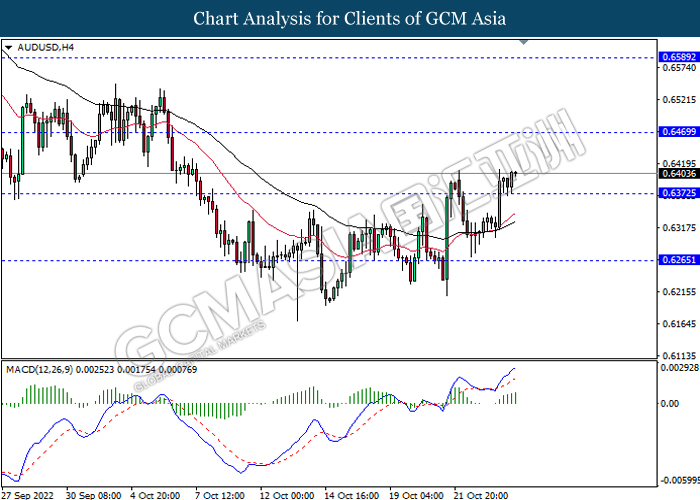

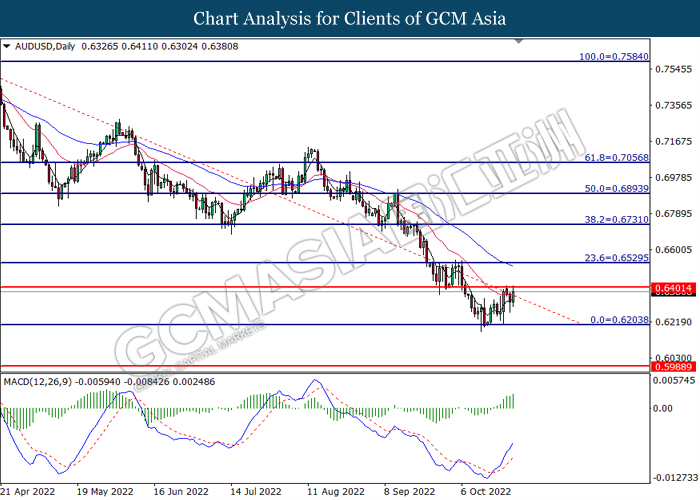

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6170

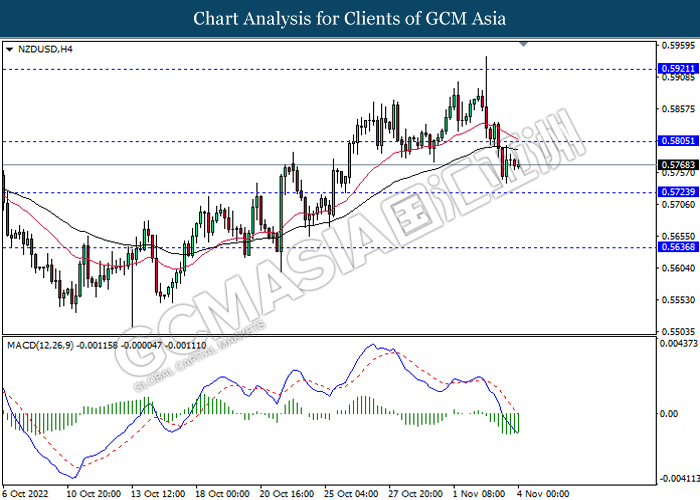

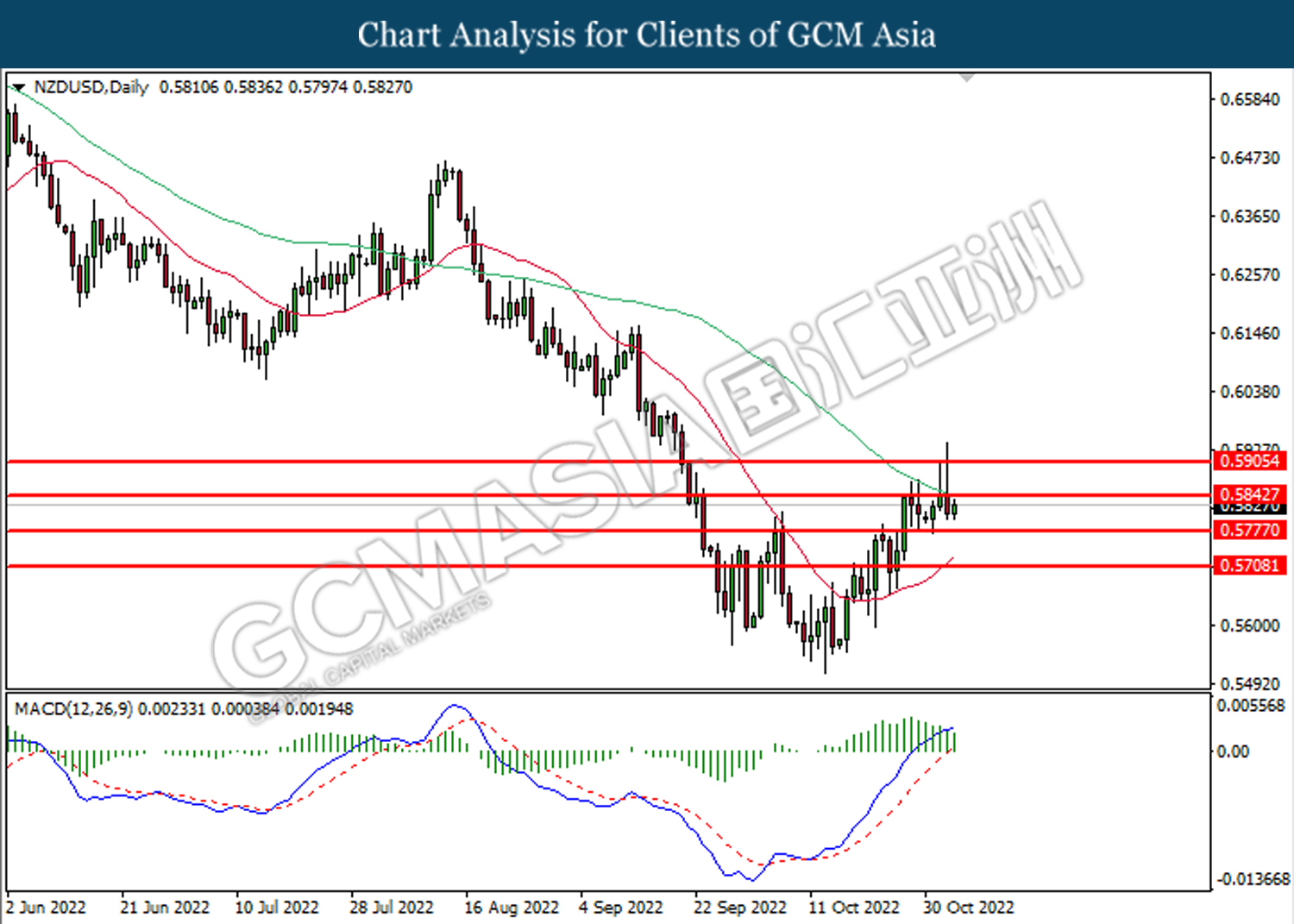

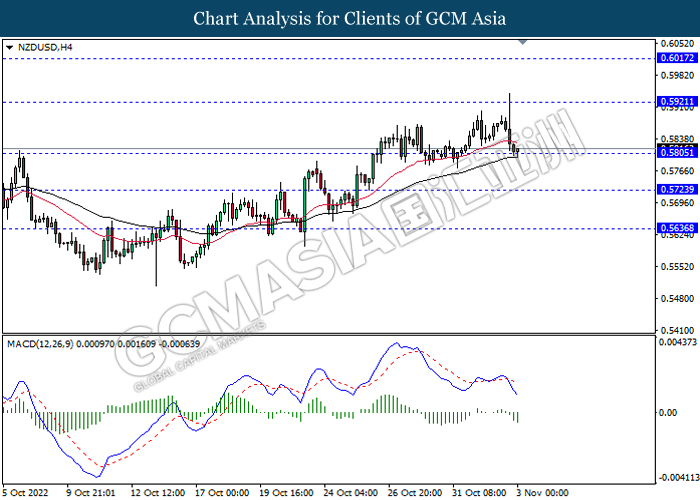

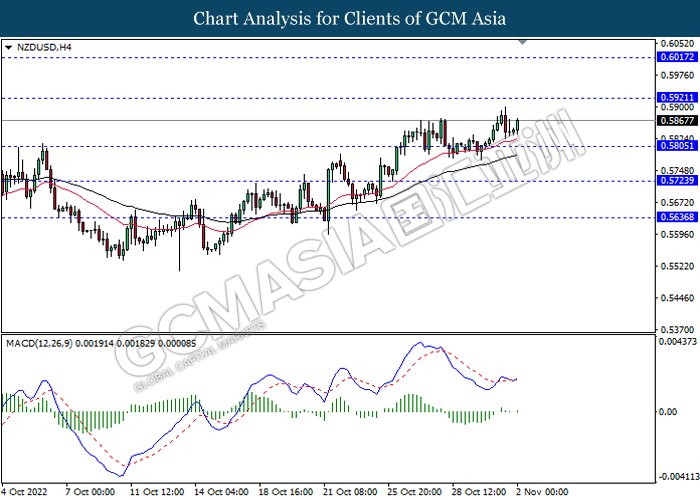

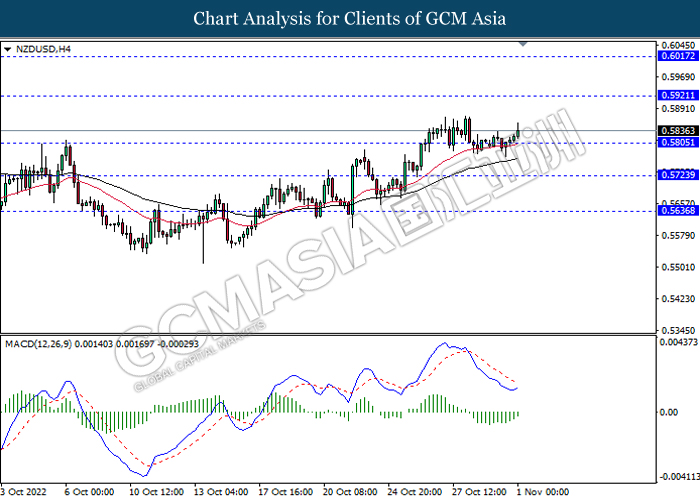

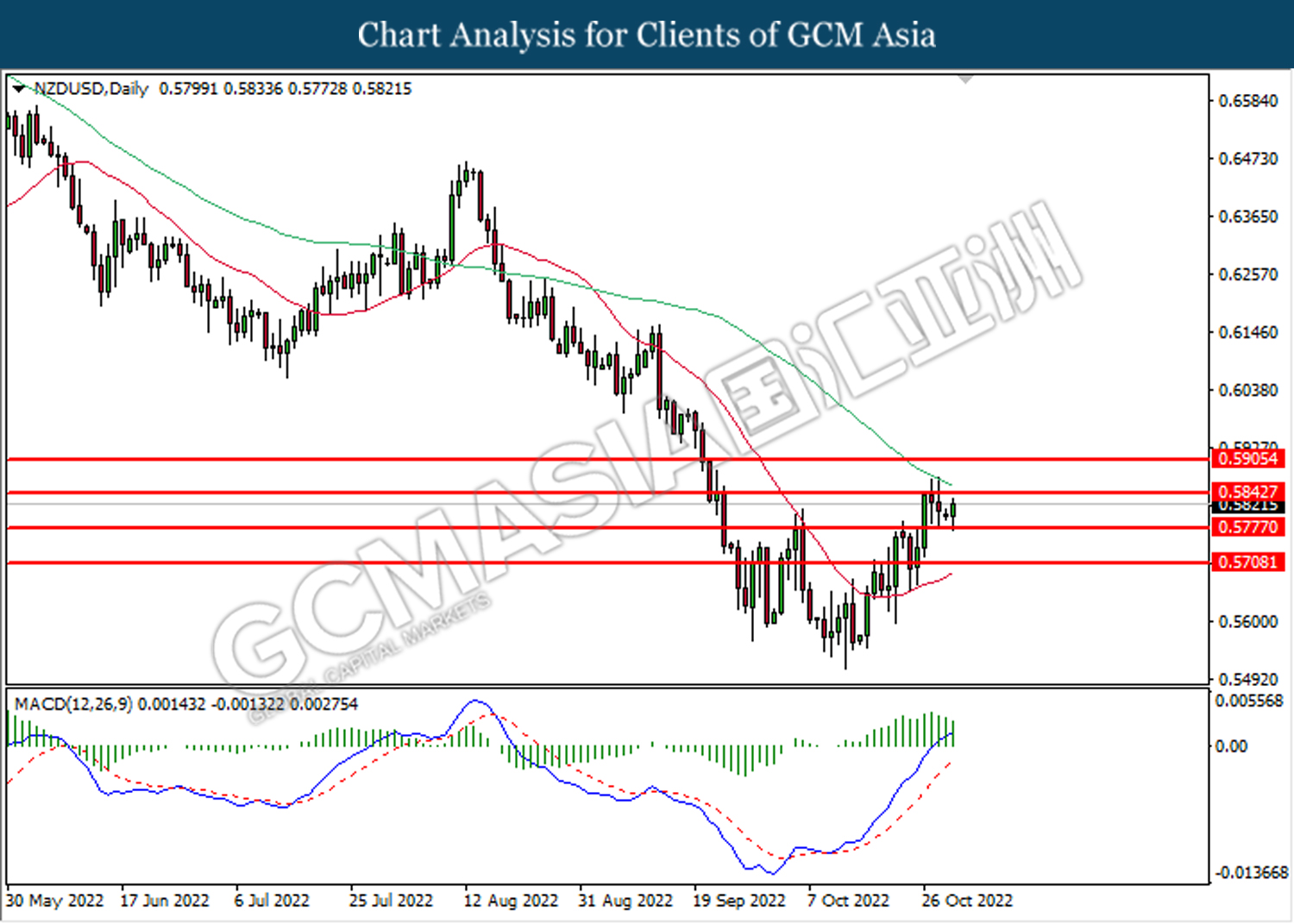

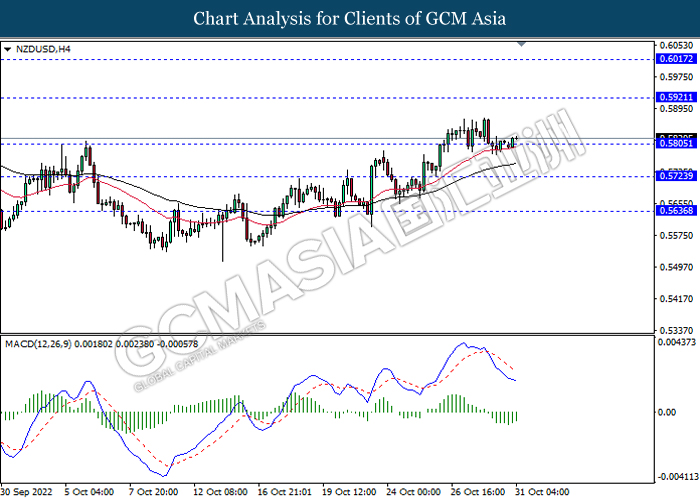

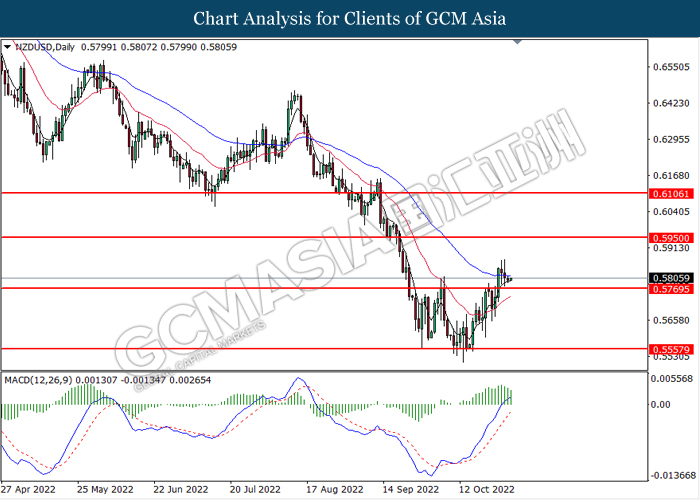

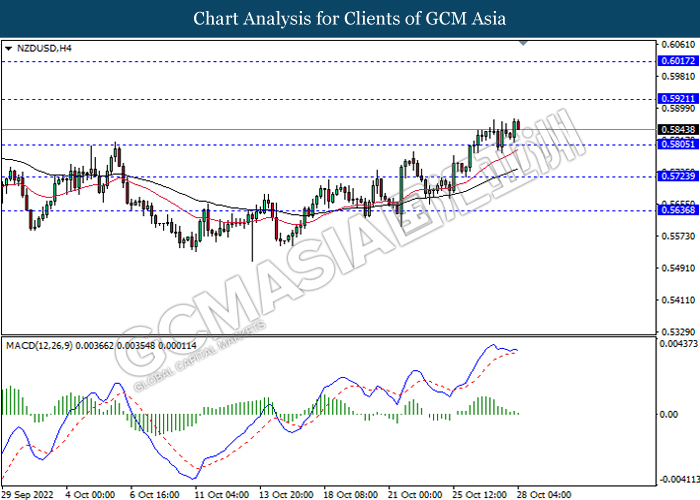

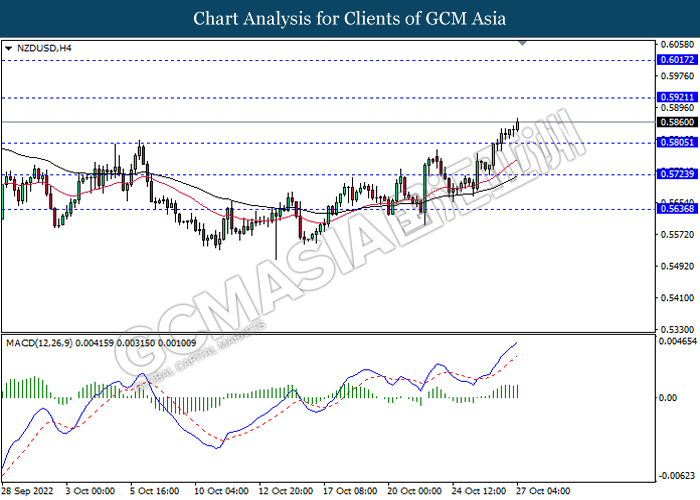

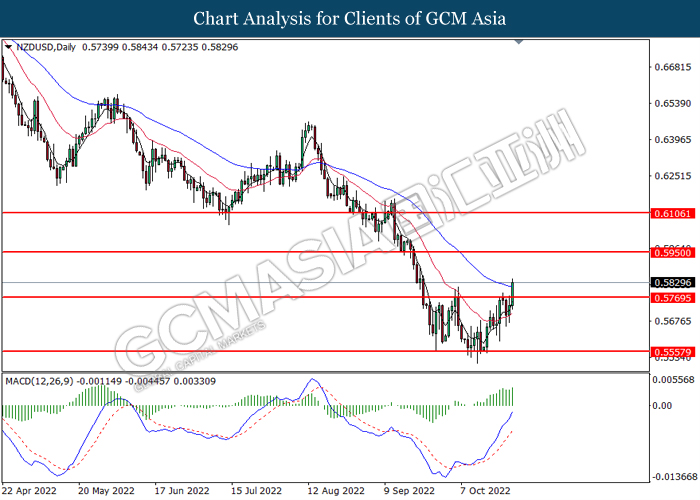

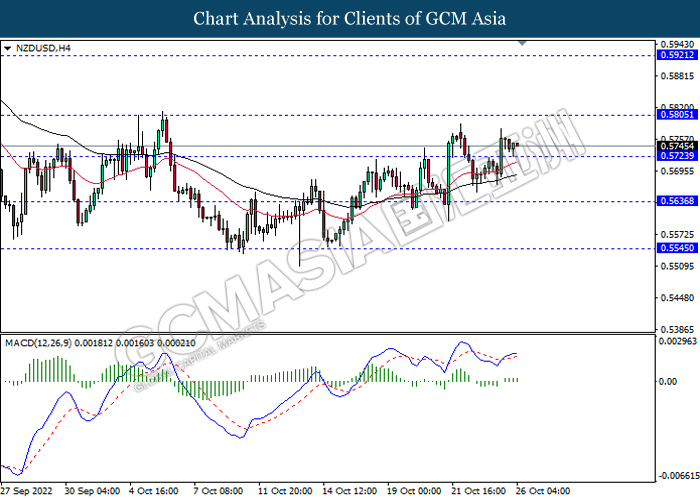

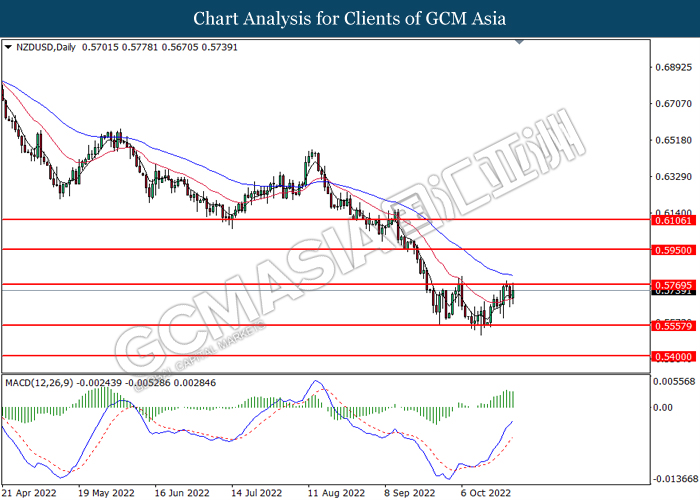

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5805, 0.5920

Support level: 0.5725, 0.5635

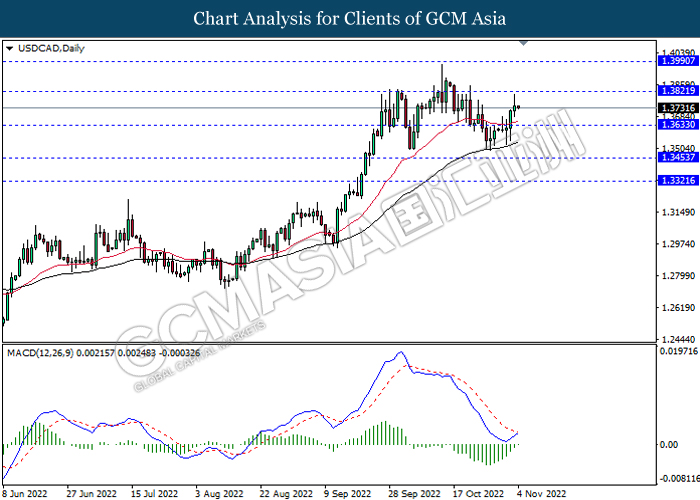

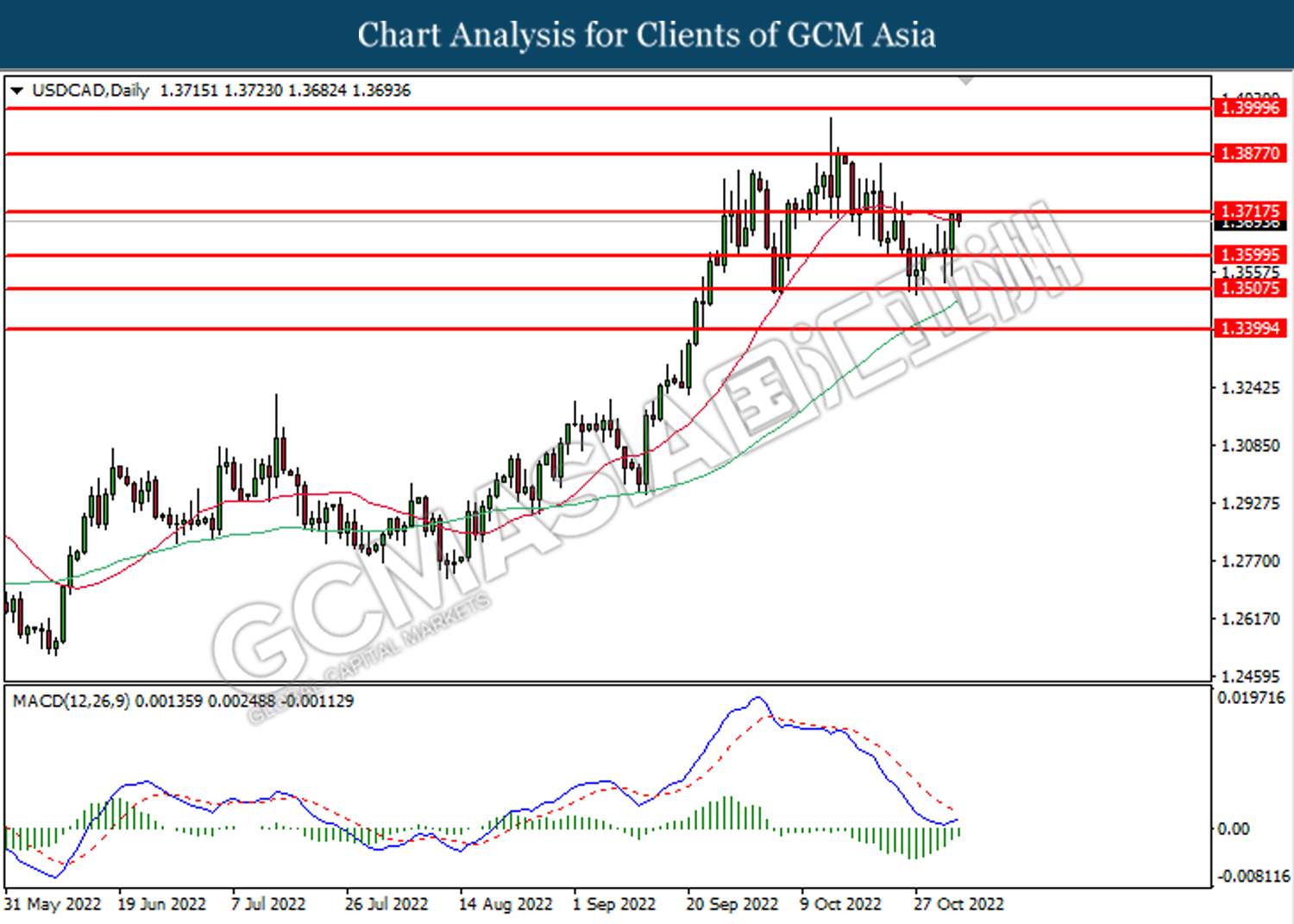

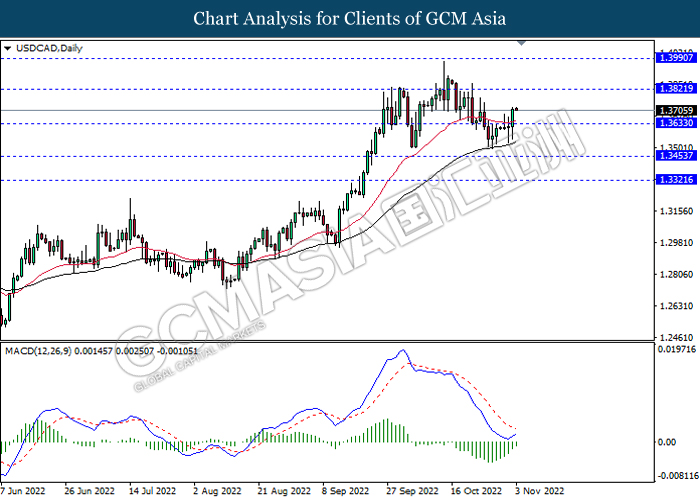

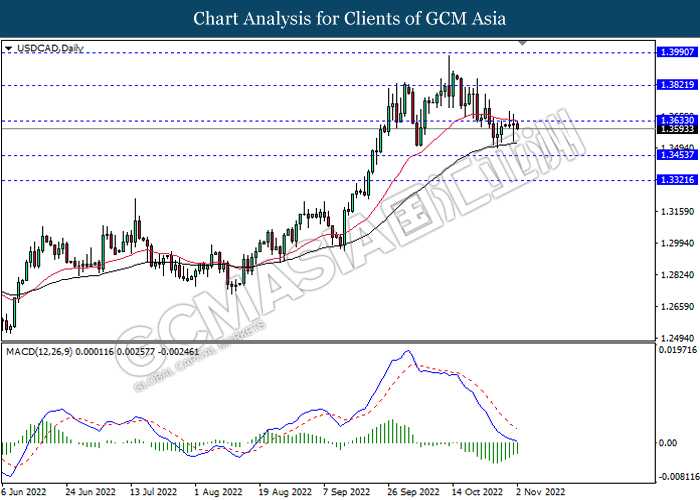

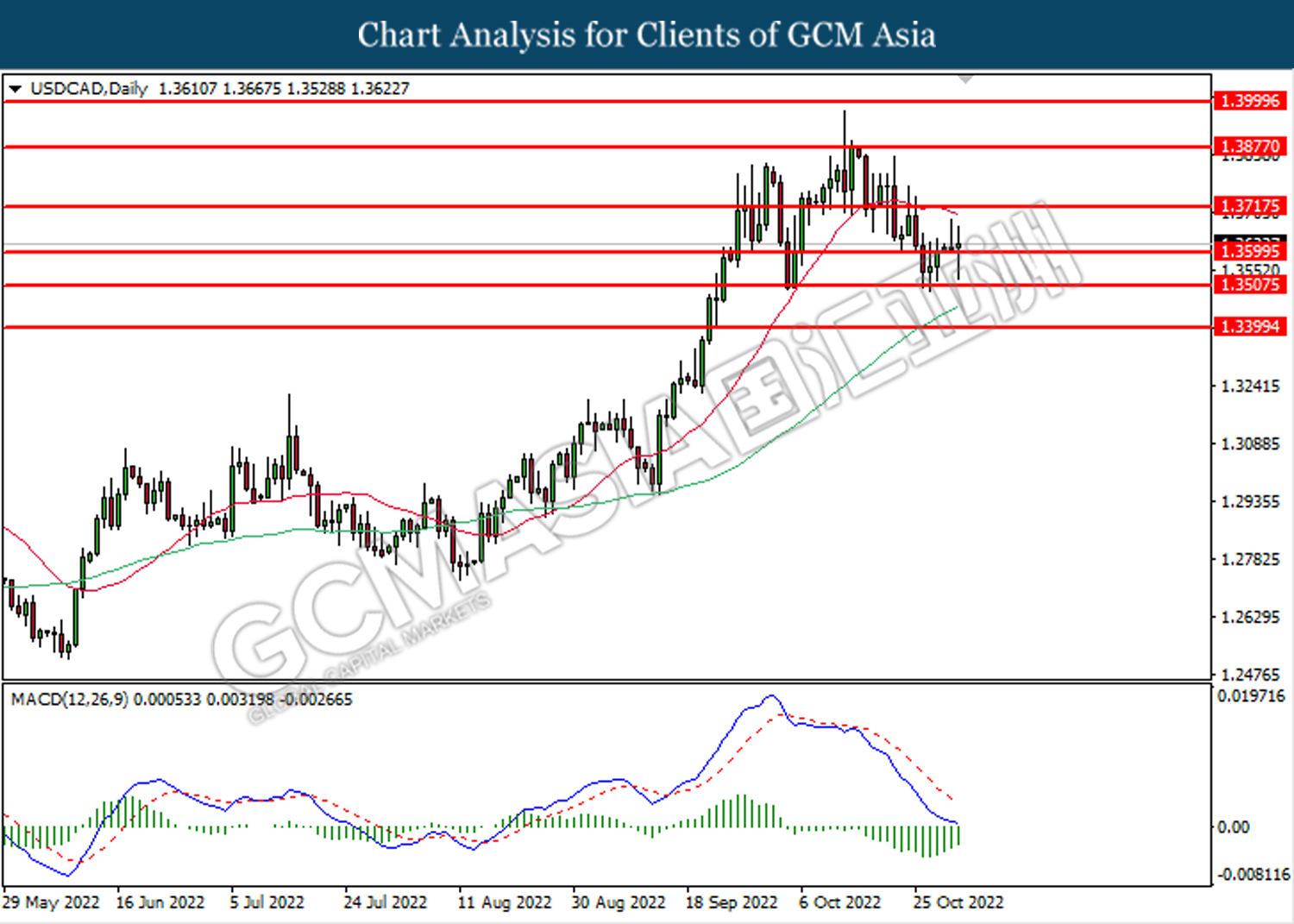

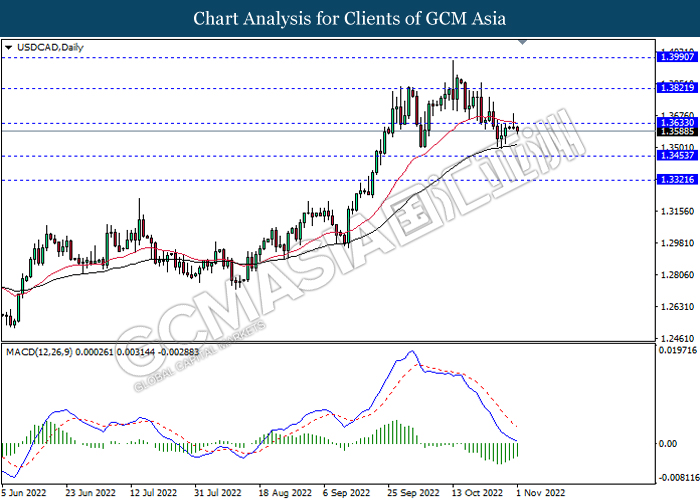

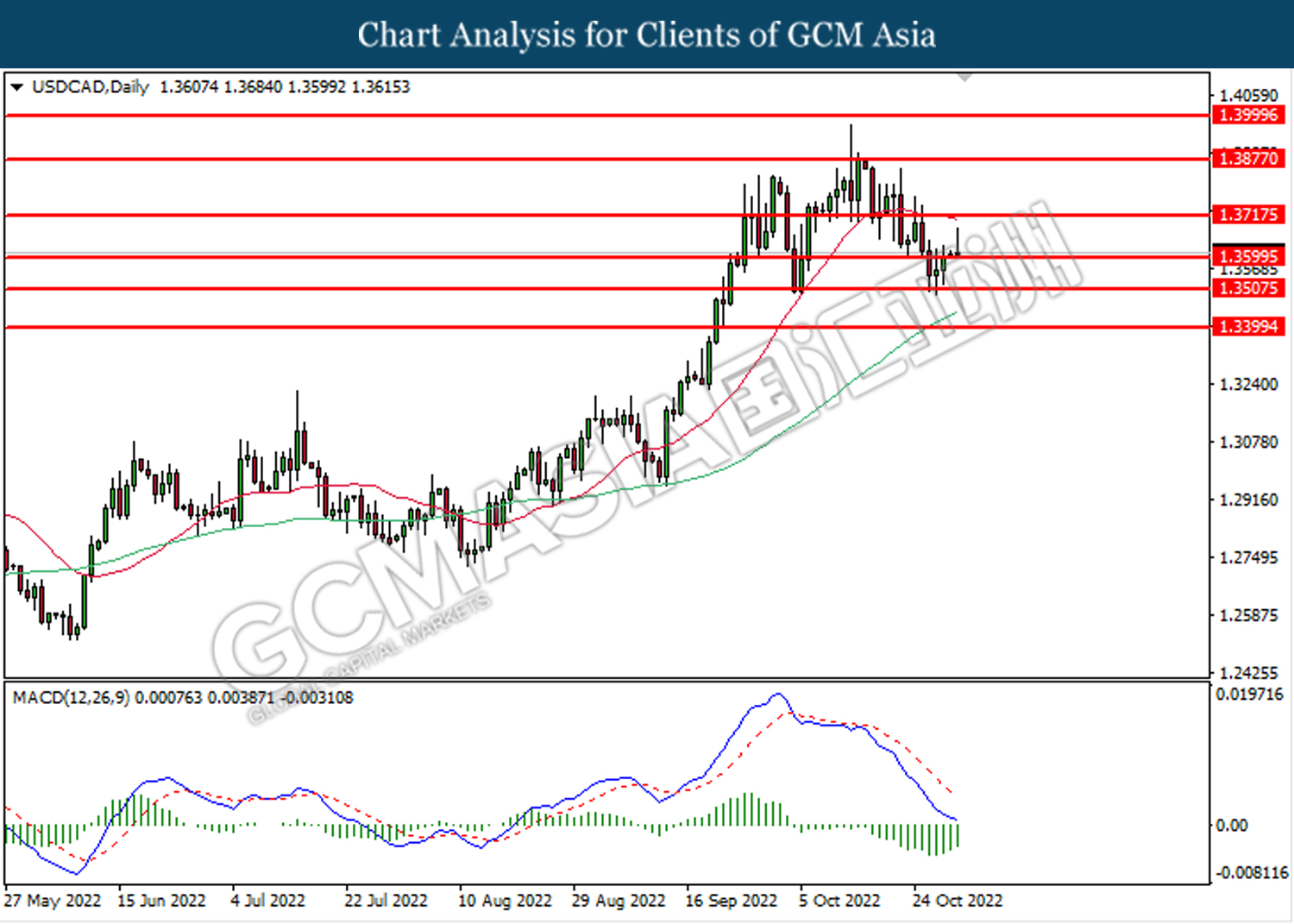

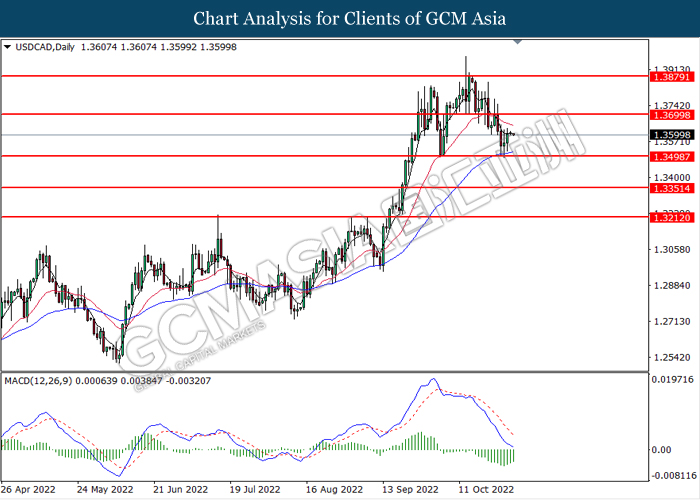

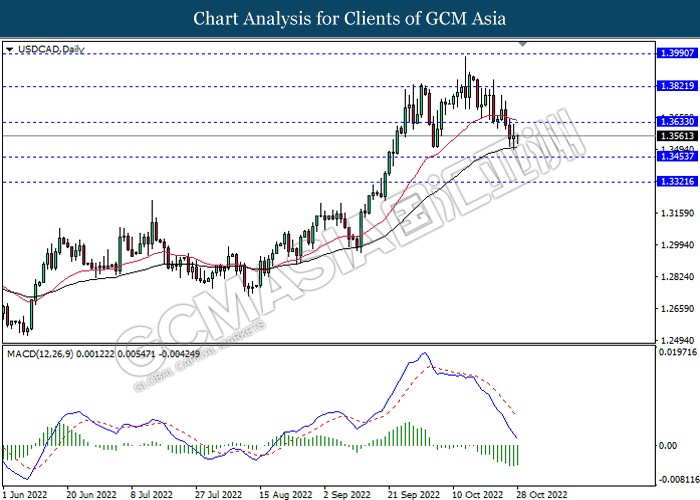

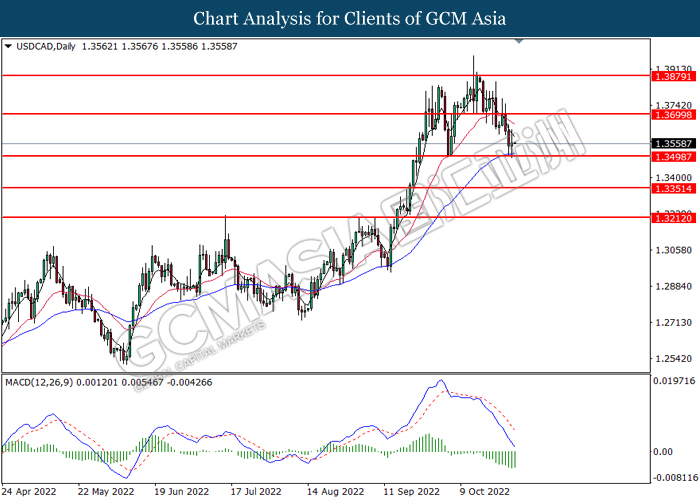

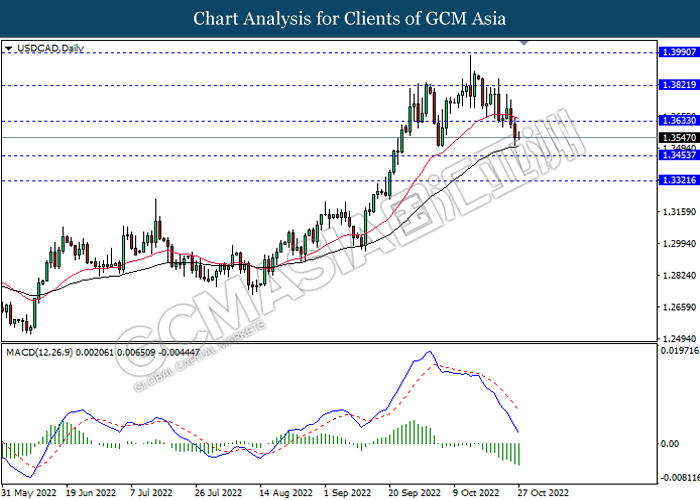

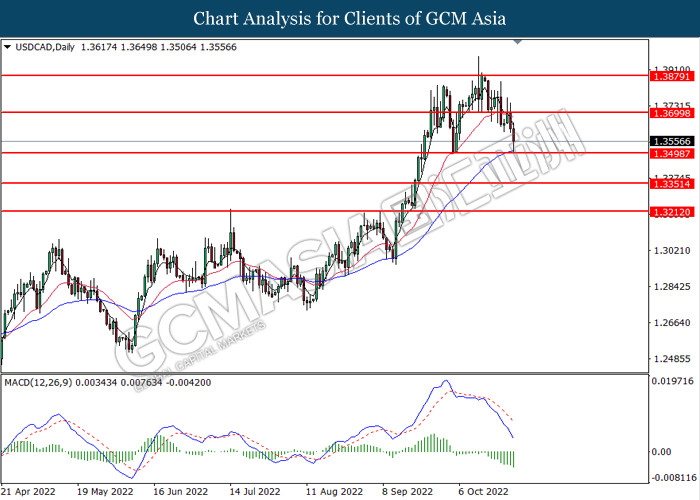

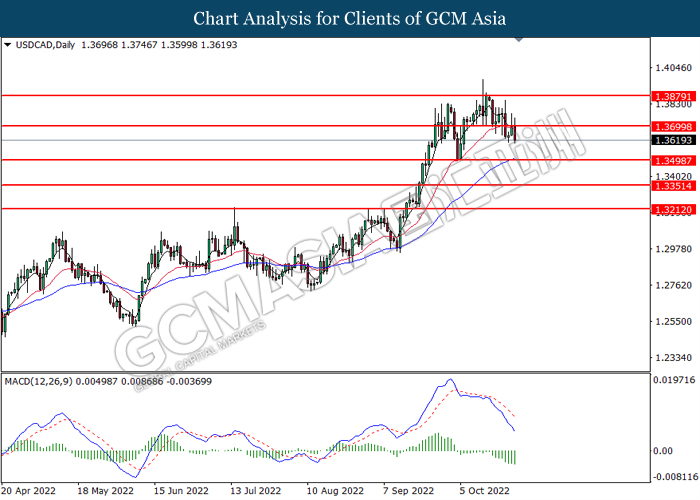

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

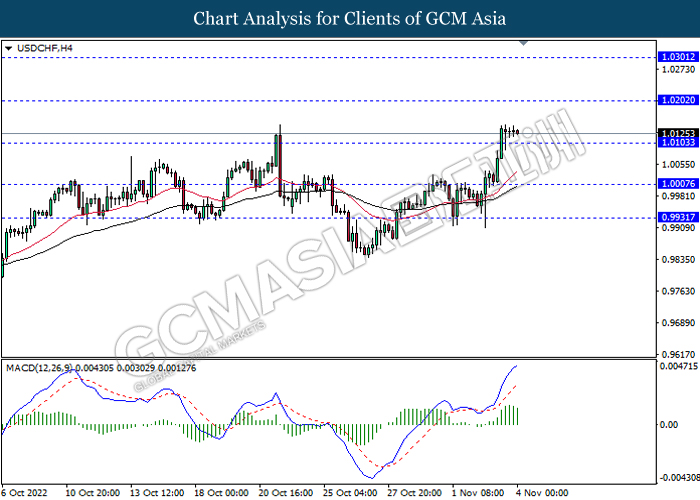

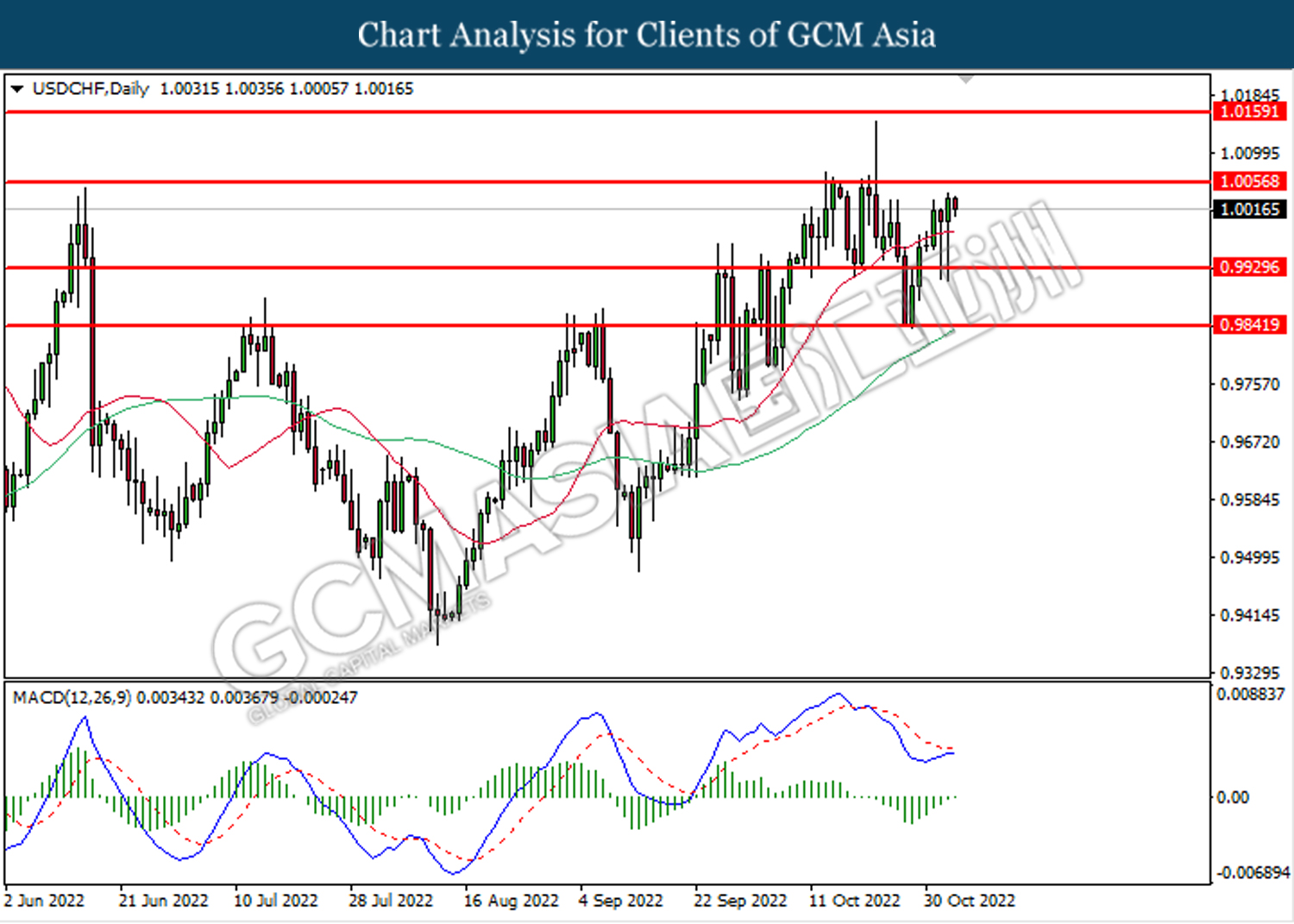

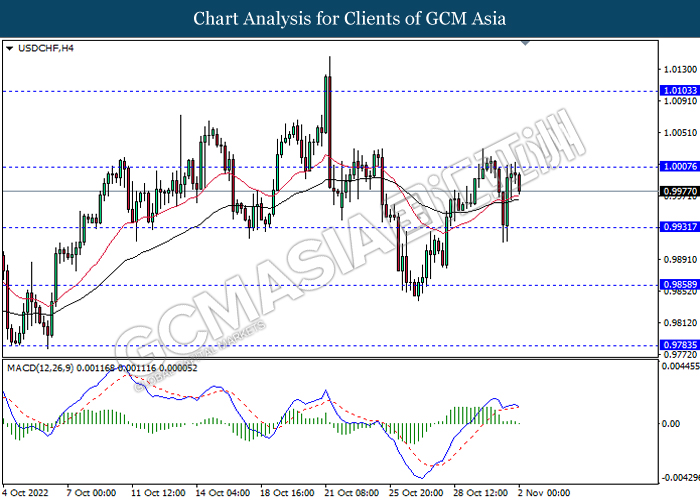

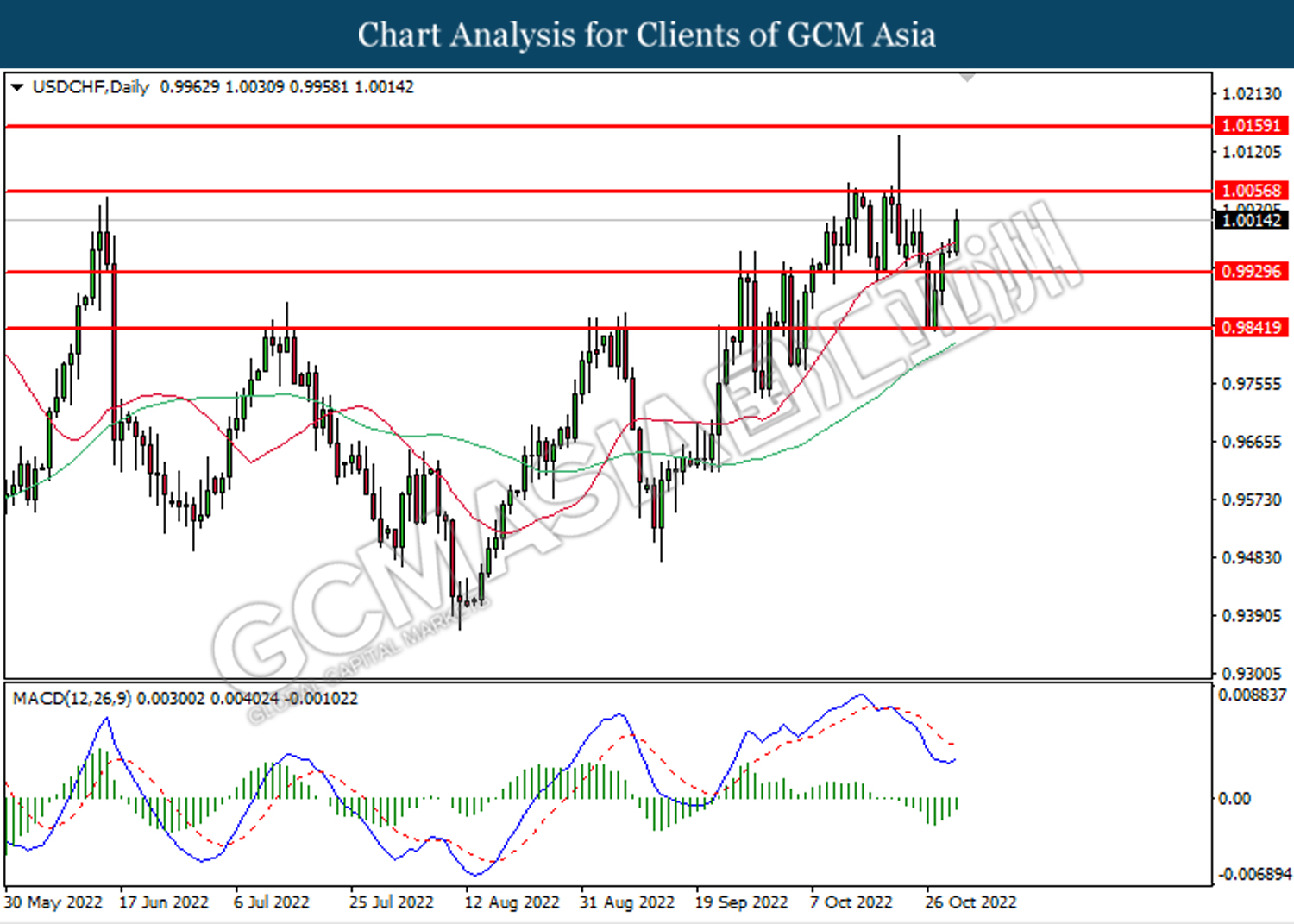

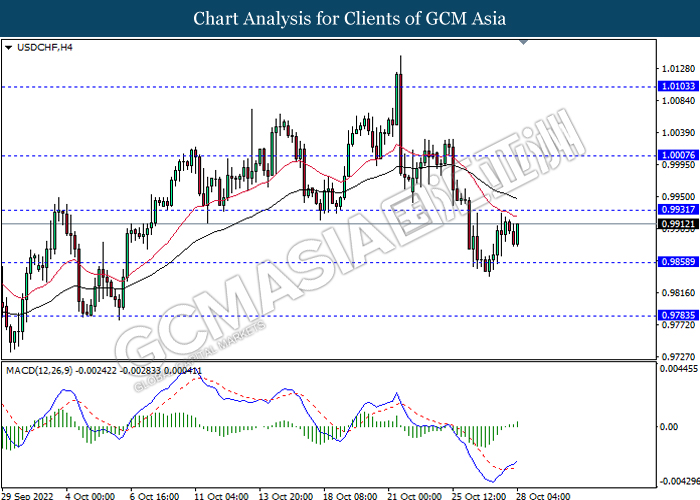

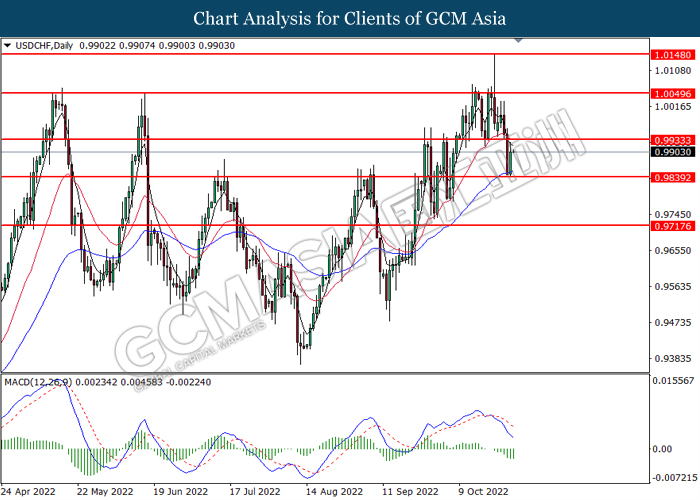

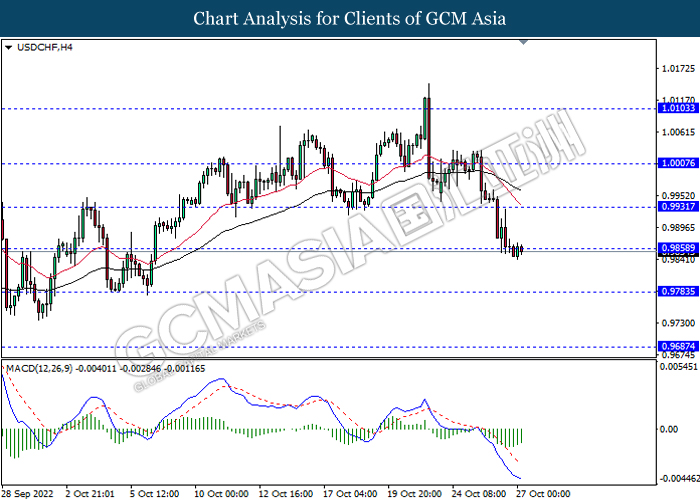

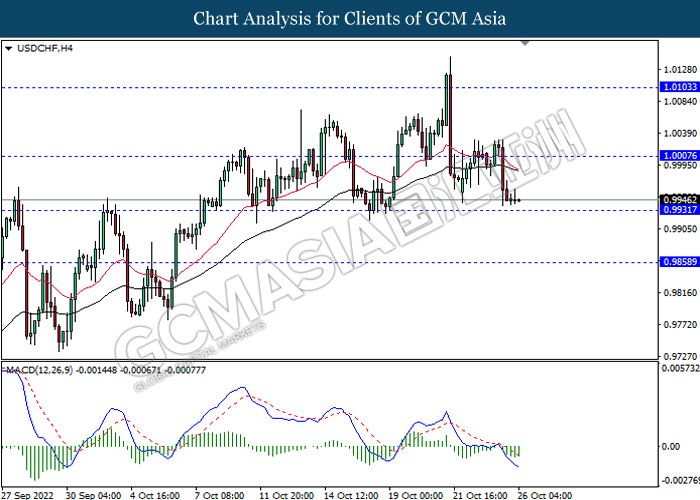

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0200, 1.0300

Support level: 1.0105, 1.0005

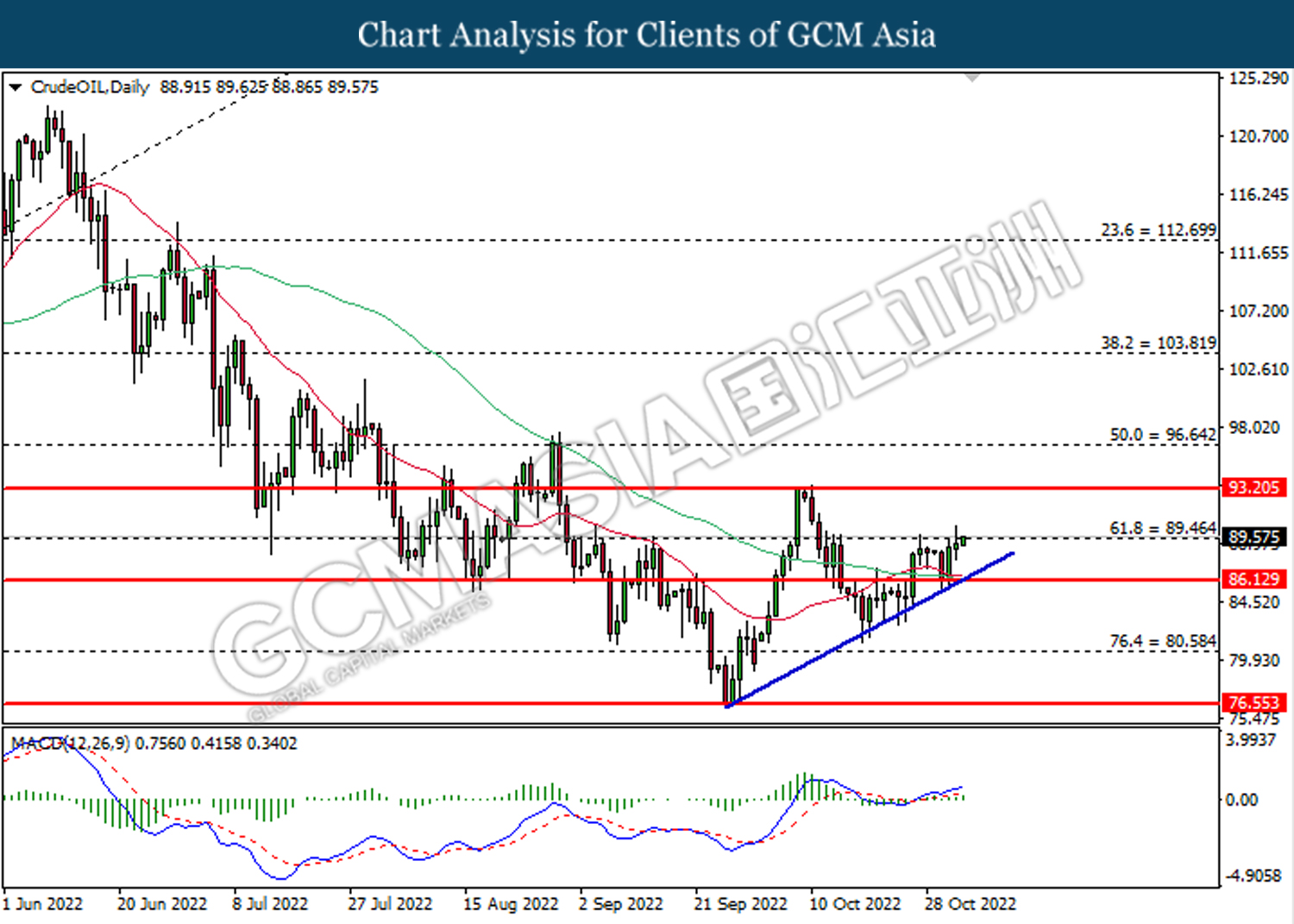

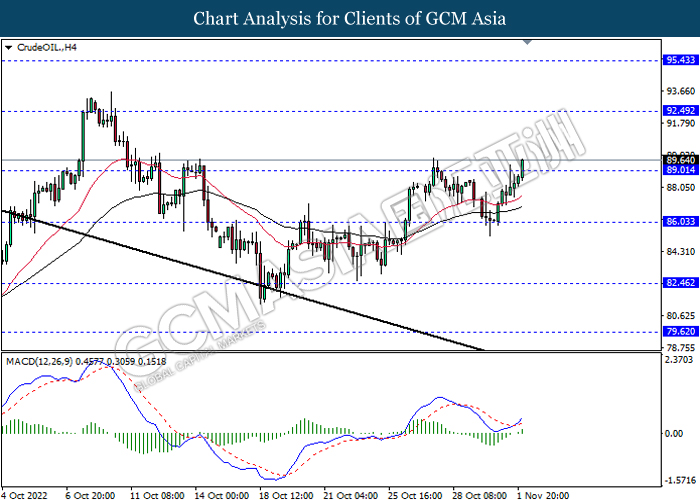

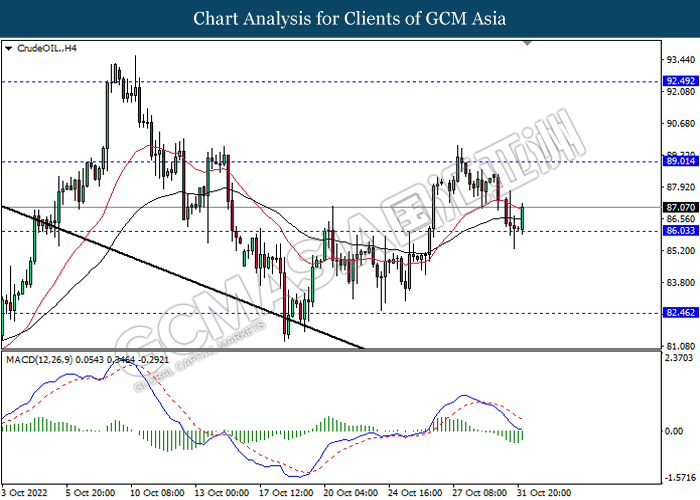

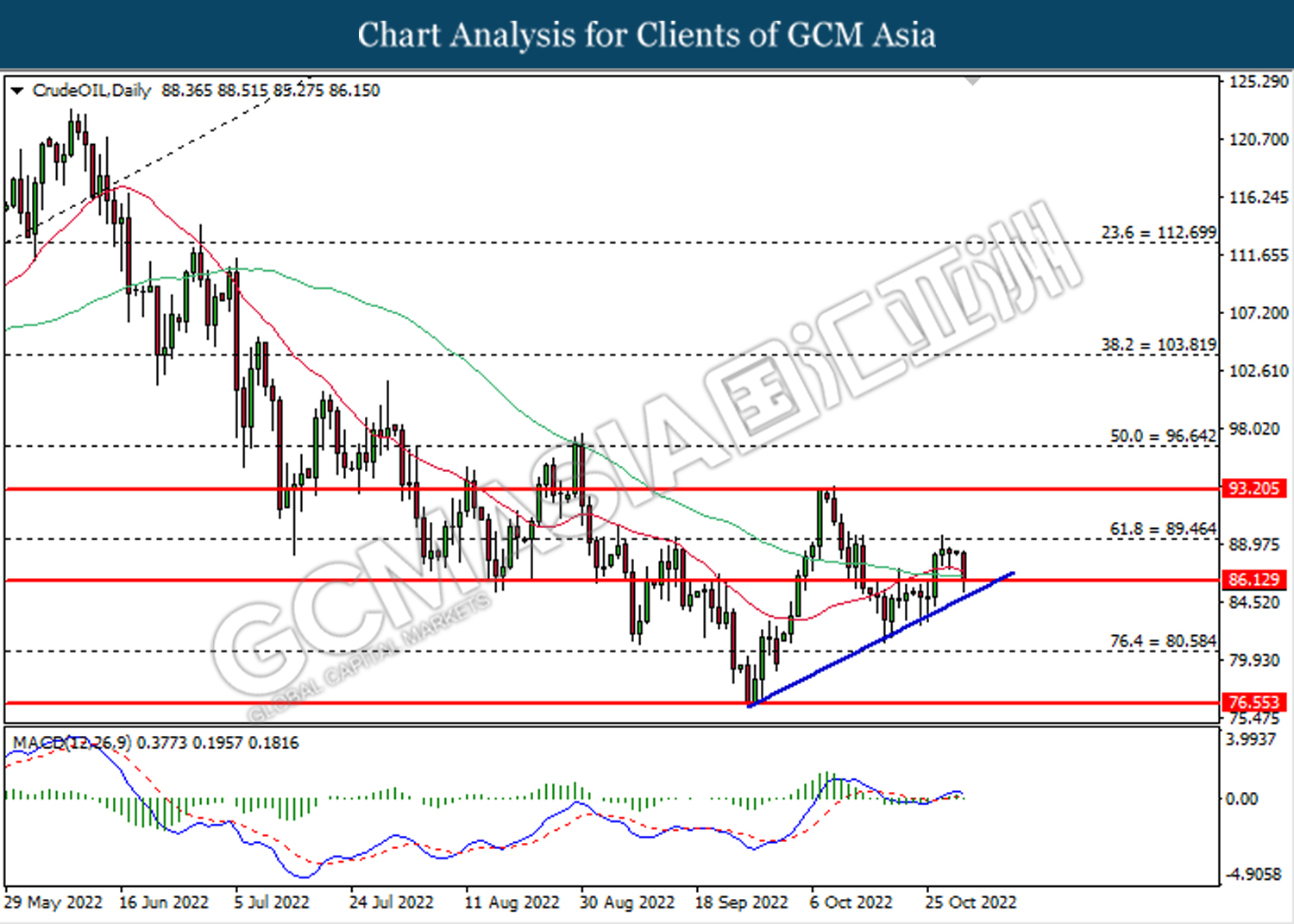

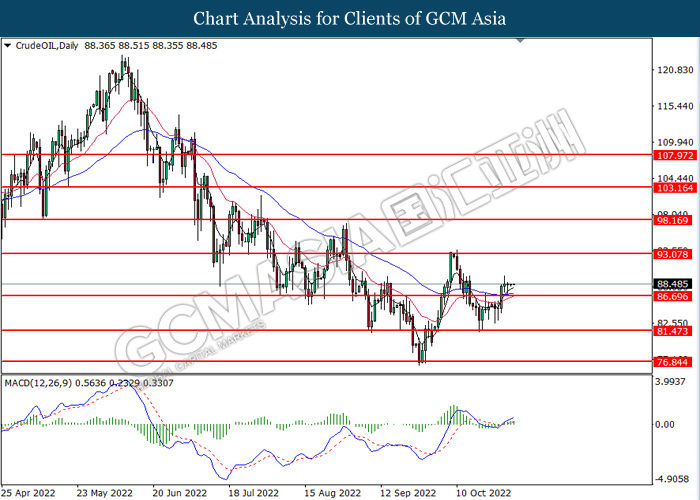

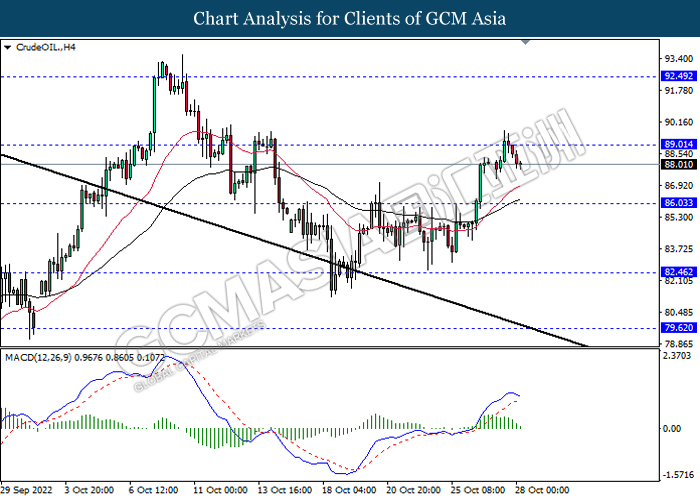

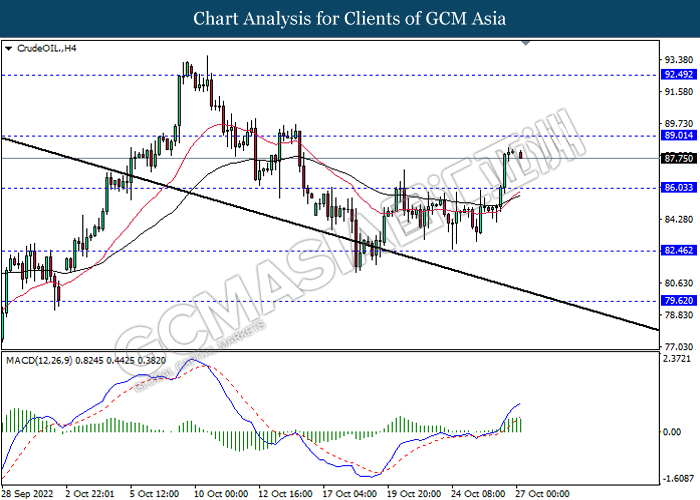

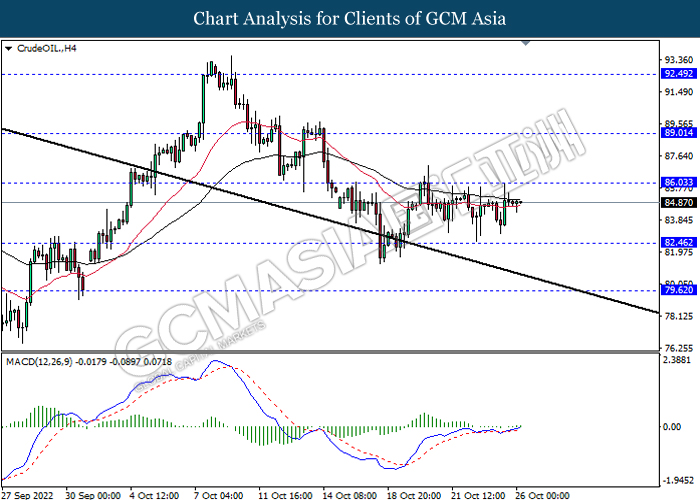

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

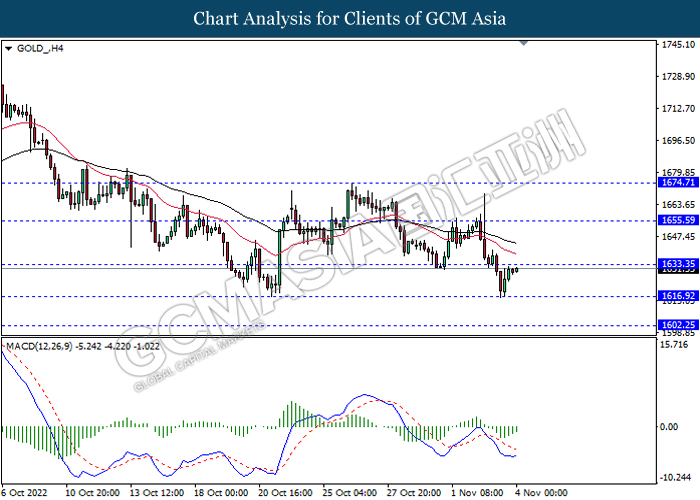

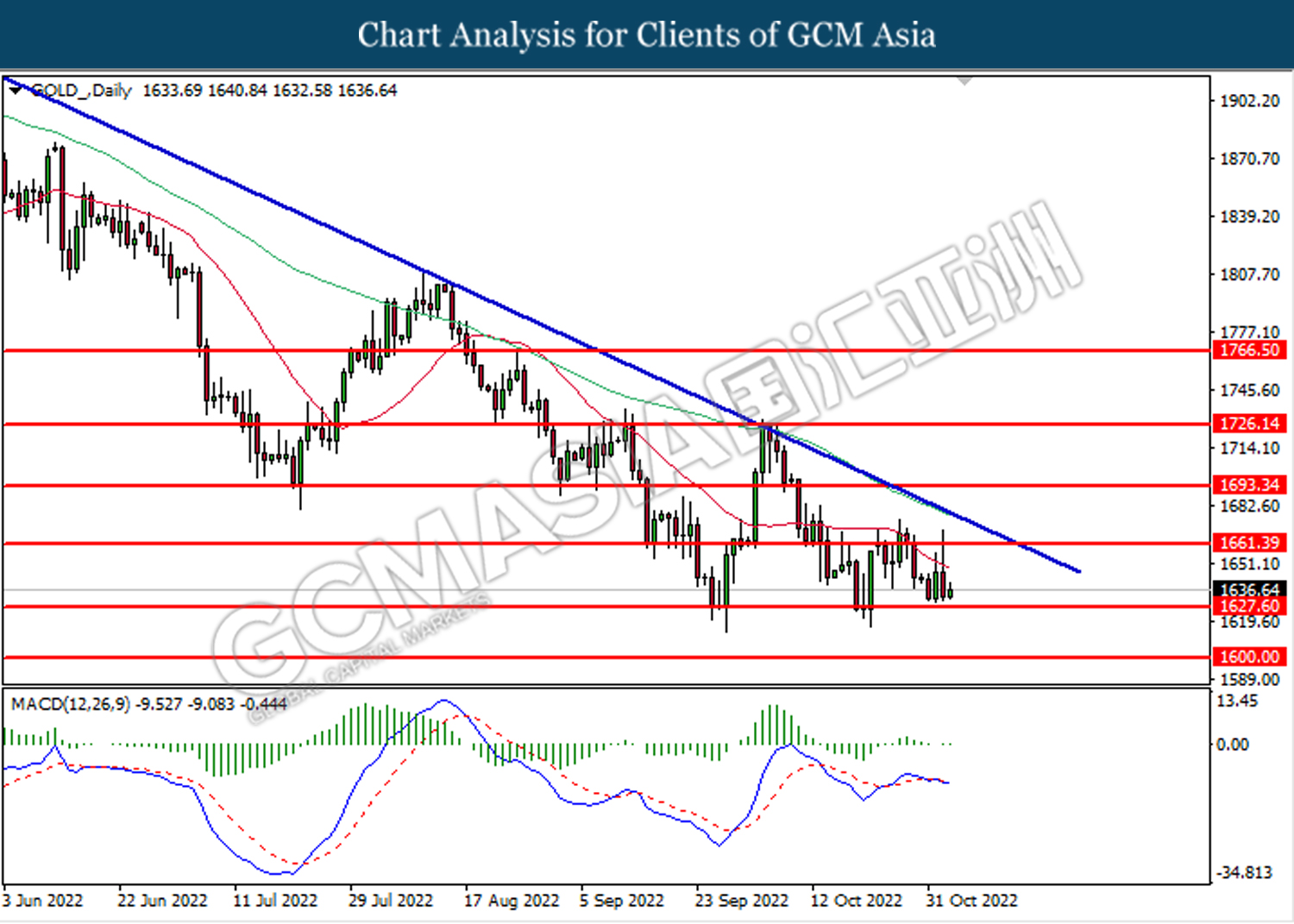

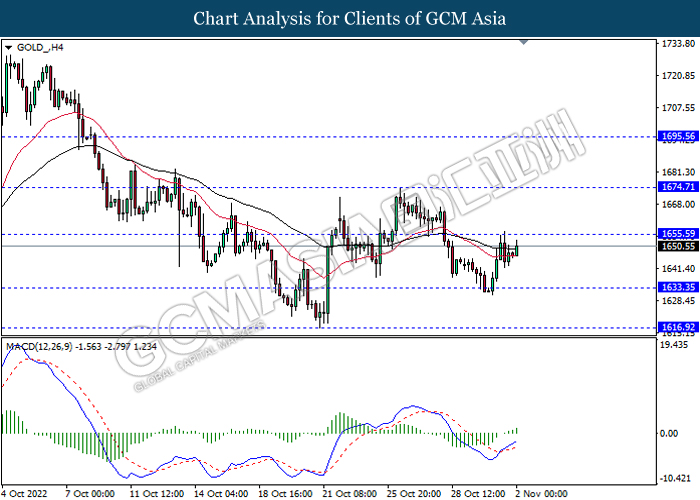

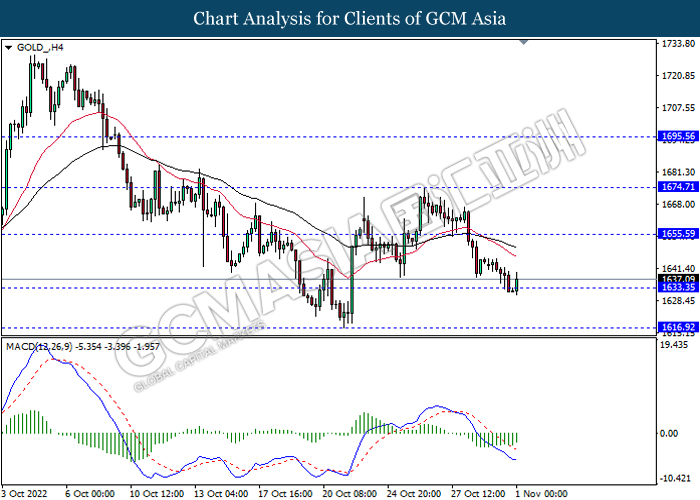

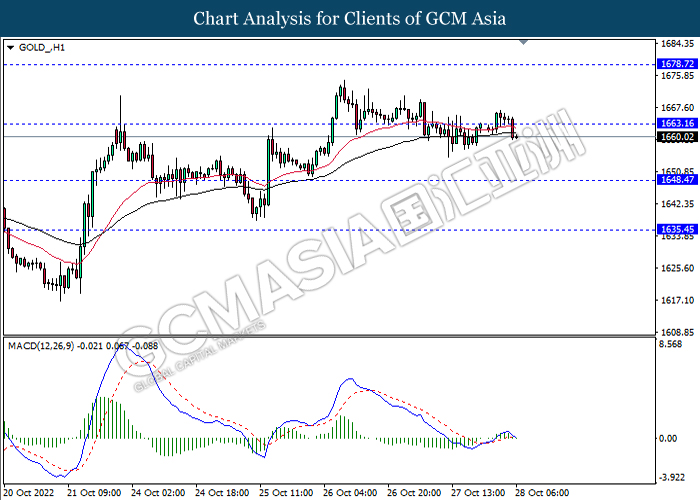

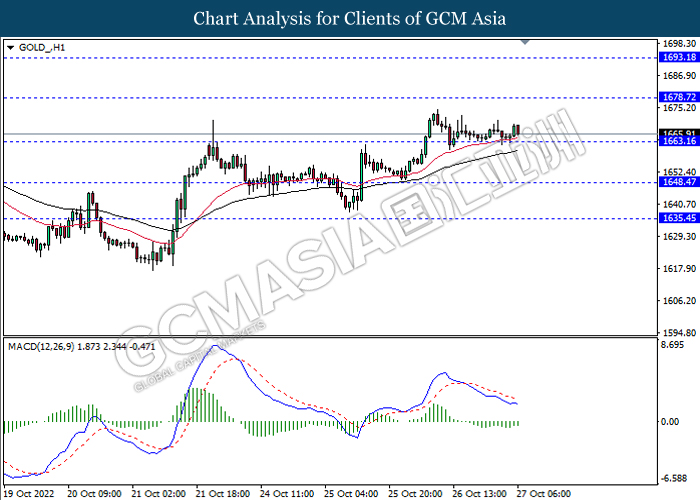

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1633.35, 1655.60

Support level: 1616.90, 1602.25

031122 Afternoon Session Analysis

3 November 2022 Afternoon Session Analysis

Pound buoyed ahead of BoE interest rate decision.

The Pound Sterling, which is widely traded by the global investors, experienced a strong rebound after plunging for more than 1.60% earlier today amid hawkish statement from the Federal Reserve Chairman Jerome Powell. However, the focus point of the investors has shifted to the upcoming Bank of England (BoE) meeting, whereby a ultra-sized of 75 basis point rate hike is expected to be carried out in the meeting. With UK inflation running at a sky-high pace of about 10.1% in September, the central bank is expected to hike the interest rate for the eight-consecutive time, with an aim to cool down the overheating economy. At the meantime, the new Prime Minister Rushi Sunak has also scrapped the controversial tax cuts plan, which rolled out by the predecessor Liz Truss. As such, the fiscal and monetary policy are now in line to tackle the high inflation. Besides, the market participants also eyeing on the other economic data such as Composite PMI and Services PMI in order to scrutinize the current economic health in UK. As of writing, the pair of GBP/USD rose 0.18% to 1.1410.

In the commodities market, the crude oil price edged up by 0.21% to $90.15 per barrel as the US inventories data showed a huge draw over the week. According to the EIA, the US crude oil inventories declined by -3.115M, missing the consensus forecast at 0.367M. Besides, the gold price rose by 0.08% to $1636.60 per troy ounce following the slight retracement in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:05 EUR ECB President Lagarde Speaks

20:30 GBP BoE Gov Bailey Speaks

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Oct) | 47.2 | 47.2 | – |

| 17:30 | GBP – Services PMI (Oct) | 47.5 | 47.5 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Nov) | 2.25% | 3.00% | – |

| 20:30 | USD – Initial Jobless Claims | 217K | 220K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Oct) | 56.7 | 55.4 | – |

Technical Analysis

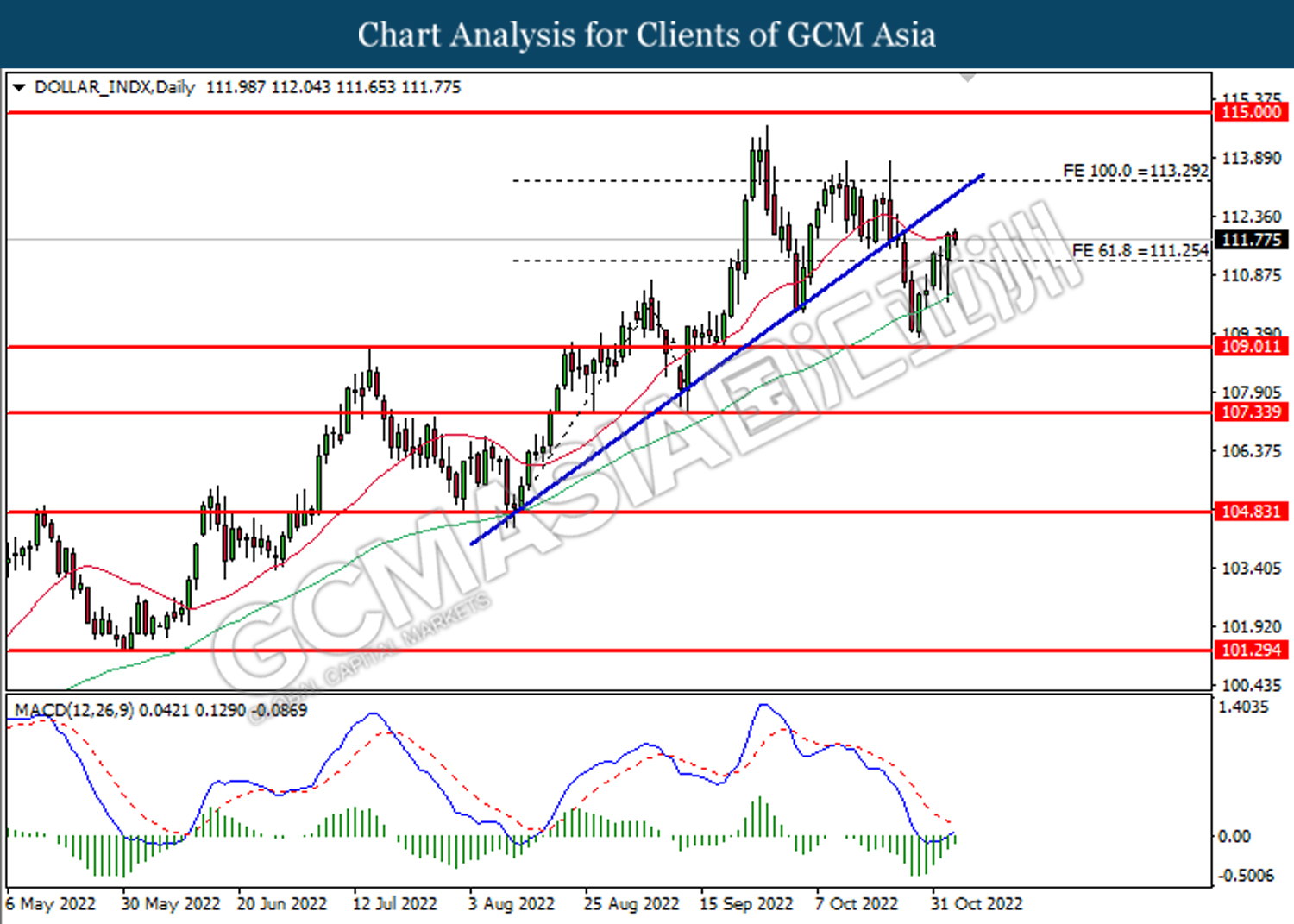

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

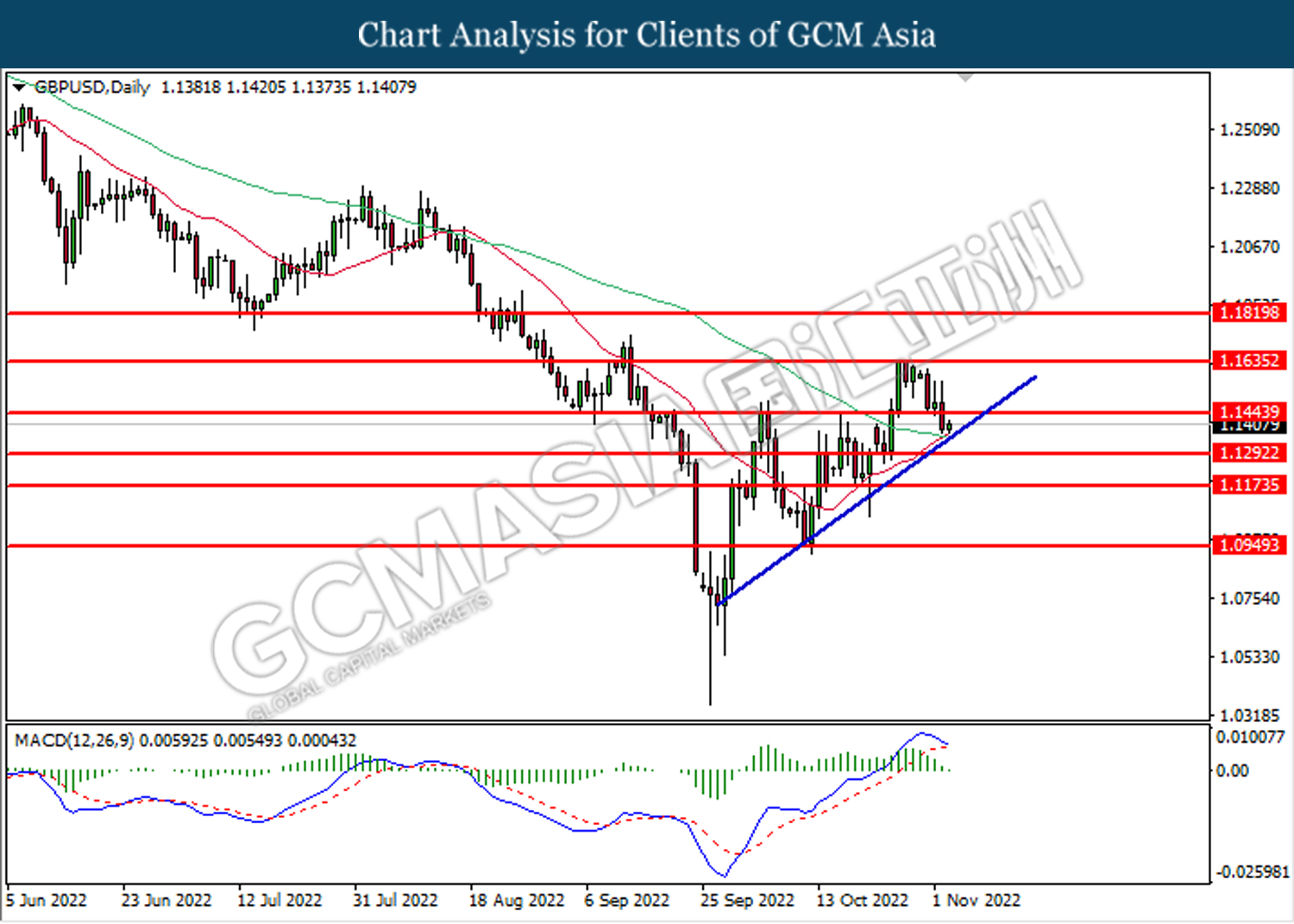

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1445. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1290.

Resistance level: 1.1445, 1.1635

Support level: 1.1290, 1.1175

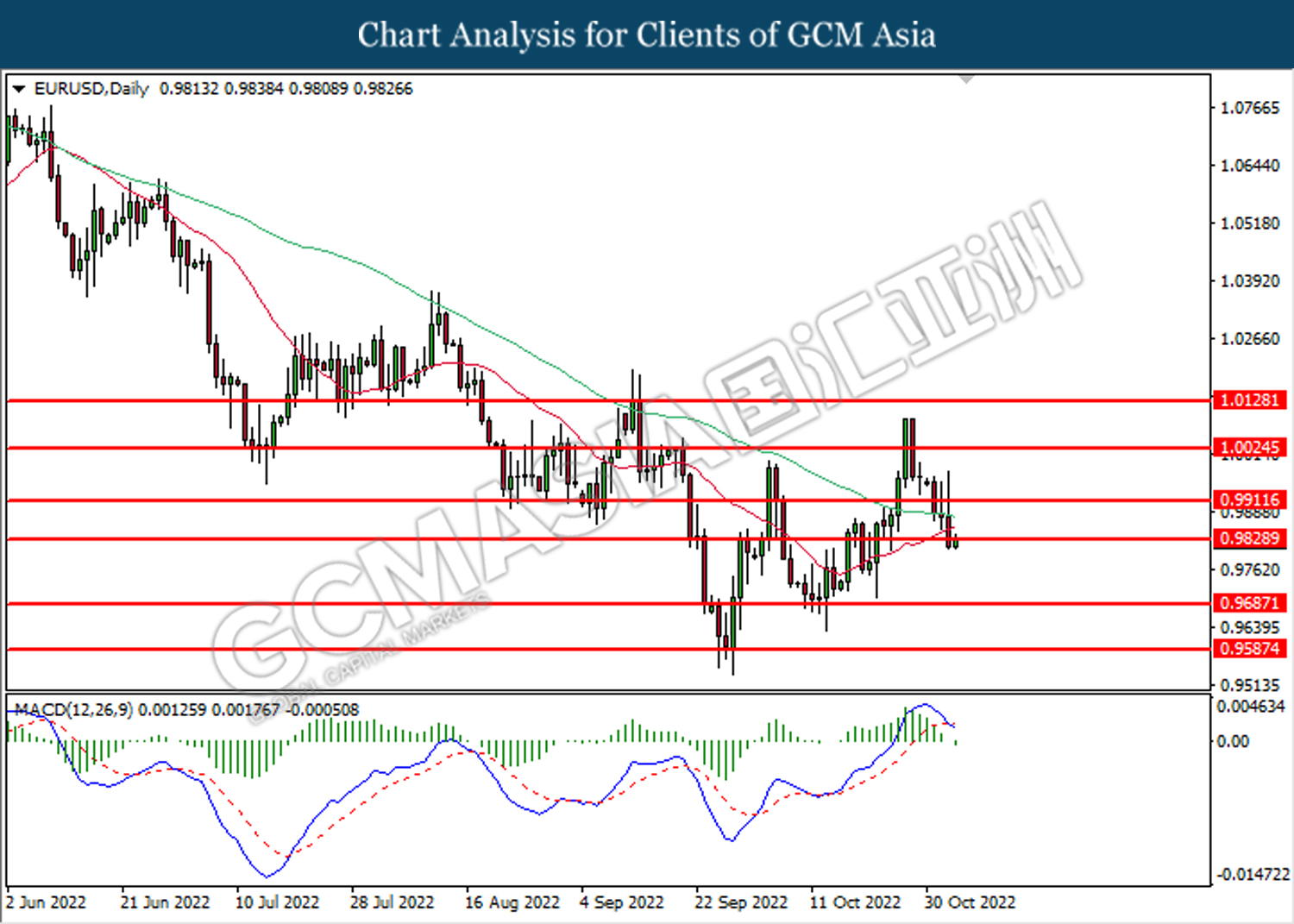

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6285.

Resistance level: 0.6400, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5845. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.5845, 0.5905

Support level: 0.5775, 0.5710

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3715. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded lower while testing near the support level at 1627.60. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00

031122 Morning Session Analysis

3 November 2022 Morning Session Analysis

US Dollar revived as aggressive rate hike path might be continued.

The Dollar Index which traded against a basket of six major currencies surged significantly in the early session trading session amid the background of hawkish statement from Fed. The US central bank has implemented a fourth consecutive 75 basis point rate hike to 4.00% on Wednesday, which bringing the rate to the highest level since January 2008. After that, Fed Chairman Jerome Powell reiterated on the FOMC Press Conference that the central bank will continue the path of aggressive rate hike in order to bring down the inflationary risk to 2% target, which sparked the appeal of US Dollar. The US CPI, which gauge the inflationary risk was running at an 8.2% annual pace in September. On the other hand, the US labor market that remained strong has also brought further bullish momentum toward US currency. The U.S. ADP Nonfarm Employment Change has notched up from the previous reading of 192K to 239K, exceeding the market expectation of 195K. As of writing, the Dollar Index appreciated by 0.06% to 112.06.

In the commodities market, the crude oil price depreciated by 1.12% to $88.99 per barrel as of writing following the aggressive rate hike expectation from Fed would likely to threaten the demand of oil. On the other hand, the gold price eased by 0.78% to $1634.90 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:05 EUR ECB President Lagarde Speaks

20:30 GBP BoE Gov Bailey Speaks

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Oct) | 47.2 | 47.2 | – |

| 17:30 | GBP – Services PMI (Oct) | 47.5 | 47.5 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Nov) | 2.25% | 3.00% | – |

| 20:30 | USD – Initial Jobless Claims | 217K | 220K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Oct) | 56.7 | 55.4 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 113.15, 114.50

Support level: 111.55, 109.95

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6170

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0200

Support level: 1.0005, 0.9930

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1655.60, 1674.70

Support level: 1633.35, 1616.90

021122 Afternoon Session Analysis

2 November 2022 Afternoon Session Analysis

Euro slipped as greenback turned stronger.

The EUR/USD, which widely traded by majority of investors dropped significantly on yesterday amid the upbeat economic data from the US, which prompting investors to shift their capitals toward US currency market. Though, the losses experienced by Euro was limited upon the hawkish speech European Central Bank (ECB). According to Reuters, ECB President Christine Lagarde reiterated on Tuesday that ECB should keep rising interest rate in order to restore price stability, even the aggressive move might lead Eurozone economy to enter recession. Besides, Christine Lagarde also vowed that the central bank would do whatever is necessary to dampen the inflation rate back to 2% target. The Eurozone inflation which rose to 10.7% has added the odds of aggressive contractionary monetary policy from ECB, which spurred bullish momentum on the Euro. On the other hand, the AUD/USD has slumped on yesterday after Reserve Bank of Australia hiked its rate by 25 basis point to 2.85%, which met the market expectation. As of writing, EUR/USD appreciated by 0.23% to 0.9897 while AUD/USD rose by 0.42% to 0.6422.

In the commodities market, the crude oil price appreciated by 1.46% to $89.66 per barrel as of writing following the upbeat manufacturing data in China has outweighed strict Covid curb. In addition, the gold price raised by 0.34% to $1652.31 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Oct) | 45.7 | 45.7 | – |

| 16:55 | EUR – German Unemployment Change (Oct) | 14K | 15K | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Oct) | 208K | 195K | – |

| 22:30 | USD – Crude Oil Inventories | 2.588M | 0.367M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 92.50, 95.45

Support level: 89.00, 86.05

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1655.60, 1674.70

Support level: 1633.35, 1616.90

021122 Morning Session Analysis

2 November 2022 Morning Session Analysis

US Dollar edged higher following a series of upbeat data.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its rally for the third consecutive trading session as yesterday’s economic data showed that the economic health in the US remains resilient. According to the Institute for Supply Management (ISM), the US Manufacturing PMI data dropped from the previous month’s reading of 50.9 to 50.2 in October, refreshing the record of the slowest growth pace in nearly two and a half years. The decline could be attributed to the effectiveness of the Fed’s aggressive rate hike plan, which seems as a result of successfully squeezing the demand for goods while cooling down inflation. However, it is noteworthy to mention that a reading above 50 still signals expansion in manufacturing. On the other hand, another last batch of economic data before the Federal Reserve meeting on 3 Nov showed that the labour market in the US remains robust. According to the Bureau of Labor Statistics, the US JOLTs Job Openings data came in at 10.717M, stronger than both the previous month’s reading as well as the consensus forecast at 10.280M and 10.000M respectively. As of writing, the dollar index rose 0.02% to 111.55.

In the commodities market, the crude oil price edged up by 0.16% to $88.65 per barrel as the US API Weekly Crude Oil Stock showed a huge draw over the week. According to the API, the US crude oil inventories declined by -6.530M, missing the consensus forecast at 0.267M. Besides, the gold price fell by -0.05% to $1647.00 per troy ounce following the rebound in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Oct) | 45.7 | 45.7 | – |

| 16:55 | EUR – German Unemployment Change (Oct) | 14K | 15K | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Oct) | 208K | 195K | – |

| 22:30 | USD – Crude Oil Inventories | 2.588M | 0.367M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1440.

Resistance level: 1.1620, 1.1835

Support level: 1.1440, 1.1185

EURUSD, Daily: EURUSD was traded lower while currently testing the upward trendline. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the trendline.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5845. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.5845, 0.5905

Support level: 0.5775, 0.5710

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1627.60. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00

011122 Afternoon Session Analysis

1 November 2022 Afternoon Session Analysis

Euro dived upon bearish economic outlook in Eurozone.

The EUR/USD, which widely traded by majority of investors slumped on yesterday despite rising inflationary risk. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY in October notched up from the previous reading of 9.9% to 10.7%, exceeding the market expectation of 10.2%. With that, European Central Bank (ECB) would likely to raise its rate forcefully to bring down the sky-high prices. Though, the possibility of aggressive rate hike from ECB in the next meeting was diminished over the pessimistic economic outlook in Eurozone. The Eurozone Gross Domestic Product (GDP) QoQ in third quarter has shown a sign of slowdown, which notched down from the previous figures of 0.8% to 0.2%. In order to avoid a more serious issue such as stagflation risk, ECB might reduce the size of rate increase, says 50 basis point or lower. On the other hand, the China-proxy currency, AUD/USD rose on early Tuesday amid the upbeat economic data from China. The China Caixin Manufacturing Purchasing Managers Index (PMI) posted at the reading of 49.2, higher tan the consensus forecast of 49.0. As of writing, EUR/USD appreciated by 0.19% to 0.9901 while AUD/USD rose by 0.67% to 0.6440.

In the commodities market, the crude oil price raised by 0.58% to $87.03 per barrel as of writing following the bullish China economic data. In addition, the gold price edged down by 0.02% to $1637.45 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Manufacturing PMI (Oct) | 45.8 | 45.8 | – |

| 22:00 | USD – ISM Manufacturing PMI (Oct) | 50.9 | 50.0 | – |

| 22:00 | USD – JOLTs Job Openings (Sep) | 10.053M | 10.000M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1655.60, 1674.70

Support level: 1633.35, 1616.90

011122 Morning Session Analysis

1 Nov 2022 Morning Session Analysis

Greenback surged ahead of another big rate hike.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its gains yesterday as the market sentiment cheered by another supersized rate increase later this week. At this juncture, the market participants are expecting the US Central Bank Federal Reserve to raise its benchmark overnight interest rate by 75 basis point to a range of 3.75% to 4.00%, as a result of fourth supersize increase in a row. However, the gains of the dollar index were limited as the investors are still waiting for the Fed signals on Thursday early morning, whether if the rate hike’s path after the November meeting will be pivoted to a slower pace. According to the FedWatch tools, the possibility of 50 basis point of rate hike in the last meeting of 2022 is as high as 47.8%, whereas the possibility of another supersize rate hike is 47.1% and there is only 5.1% of possibility that the Federal Reserve will have a 25-basis point of rate hike. As of writing, the dollar index rose 0.75% to 111.60.

In the commodities market, the crude oil price edged down by -0.21% to $86.75 per barrel following the dollar index strengthened, whereby it increased the cost of oil product toward the non-US buyer. Besides, the gold prices dropped -0.03% to $1633.15 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Nov) | 2.60% | 2.85% | – |

| 17:30 | GBP – Manufacturing PMI (Oct) | 45.8 | 45.8 | – |

| 22:00 | USD – ISM Manufacturing PMI (Oct) | 50.9 | 50.0 | – |

| 22:00 | USD – JOLTs Job Openings (Sep) | 10.053M | 10.000M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1440.

Resistance level: 1.1620, 1.1835

Support level: 1.1440, 1.1185

EURUSD, Daily: EURUSD was traded lower while currently testing the upward trendline. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the trendline.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5770. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.5845, 0.5905

Support level: 0.5775, 0.5710

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 86.15.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1661.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1627.60.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00

311022 Afternoon Session Analysis

31 October 2022 Afternoon Session Analysis

Pound Sterling rose upon budget plan from UK Prime Minister.

The GBP/USD, which widely traded by global investors rebounded from recent low on last Friday after the new UK Prime Minister announced his first budget plan. According to Reuters, Rishi Sunak, who started his tenure as UK Prime Minister on last week has claimed on 28 October that he was considering to postpone the country’s foreign aid budget for an additional two years to 2026 – 2027. Earlier, Rishi Sunak was inclined to reduce government spending, and the plan was the first step to achieve the goal. Besides, the tax cuts cancellation was also under consideration of UK government in order to stabilize the spiking inflationary pressures, which sparking the appeal of Pound Sterling. As of now, investors would continue to scrutinize the latest updates with regards of budget plans from Rishi Sunak government. In addition, the interest rate decision from Bank of England which scheduled on Thursday would also be closely watched by investors. As of writing, GBP/USD edged down by 0.03% to 1.1609.

In the commodities market, the crude oil price dropped by 0.46% to $87.50 per barrel as of writing following the downbeat economic data had weigh down the demand on this black commodity. The China Manufacturing Purchasing Managers Index (PMI) has notched down from the previous reading of 50.1 to 49.2, missing the market forecast of 50.0. On the other hand, the gold price appreciated by 0.14% to $1643.98 per troy ounce as of writing over the depreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 9.9% | 10.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9990, 1.0095

Support level: 0.9905, 0.9810

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1648.45, 1663.15

Support level: 1635.45, 1624.30

311022 Morning Session Analysis

31 October 2022 Morning Session Analysis

Greenback standstill ahead of Fed meeting’s week.

The dollar index, which traded against a basket of six major currencies, managed to hold its ground in the early trading session as the market participants are preparing for a ‘busy’ week ahead. Last Friday, the Bureau of Economic Analysis released the US Core PCE Price Index data. The data came in at 0.5%, in line with the consensus forecast, showing that the inflation stayed strong in September. With that, the greenback was pushed up following the release of the data, while the market participant has started to shift their attention to the upcoming data. In the next few trading days, the greenback is expected to have large movement as the Federal Reserve will hold its meeting during 2nd Nov – 3rd Nov, whereby the rate hike plan of the Federal Reserve would be critical to the market participants. The central bank is expected to raise rates by 75 basis points for the fourth-straight time before “pivoting” to a slower pace of rate hikes, which the market has begun pricing in. Besides, investors will also eyes on the Friday’s NonFarm Payroll data and Unemployment data to gauge the current situation of the labor market. As of writing, the dollar index dropped -0.02% to 110.75.

In the commodities market, crude oil prices edged down by -0.17% to $89.05 per barrel as China widen Covid curbs. Besides, gold prices appreciated by 0.11% to $1644.85 per troy ounce following the slight fall in dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 9.9% | 10.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 110.00. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward the resistance level at 111.70.

Resistance level: 111.70, 114.00

Support level: 110.00, 107.90

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

EURUSD, Daily: EURUSD was traded lower following prior retracement near the resistance level at 1.0025. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9900.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.50. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 150.15.

Resistance level: 150.15, 152.50

Support level: 147.50, 144.70

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6730

Support level: 0.6400, 0.6205

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5950.

Resistance level: 0.5950, 0.6105

Support level: 0.5770, 0.5560

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3500. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3700.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9935. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0050.

Resistance level: 1.0050, 1.0150

Support level: 0.9935, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 86.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 93.10.

Resistance level: 93.10, 98.15

Support level: 87.70, 81.45

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1638.40. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1660.90.

Resistance level: 1660.90, 1677.80

Support level: 1638.40, 1615.40

281022 Afternoon Session Analysis

28 October 2022 Afternoon Session Analysis

Euro slumped despite jumbo rate hike from ECB.

The EUR/USD, which traded by majority of investors dropped significantly on yesterday although European Central Bank (ECB) hiked its interest rate. Yesterday, ECB increased its interest rate by 75 basis point to 2.00%, the highest level since 2009, which met with the consensus forecast. Nonetheless, the Euro retraced from the level around 1.0095 upon the rate differential between Fed and ECB. In the earlier moment, Fed has raised its rate to 3.25%, as well as 0.75% rate hike might be implemented again in the meeting which scheduled on next week. In the perspective of investors, they are more willing to shift their capital toward US currency market to earn higher return, which spurred bearish momentum on the Euro. Though, the losses experienced by EUR/USD was limited over the hawkish statement from ECB. According to Reuters, the ECB claimed on Thursday that the rate hike path would be continued to restore price stability, and the size of rate increase is going to be discussed. As of writing, the EUR/USD rose by 0.26% to 0.9988.

In the commodities market, the crude oil price eased by 1.15% to $88.06 per barrel as of writing as the Covid-19 issue in China keep threatening the demand of oil. On the other hand, the gold price appreciated by 0.12% to $1663.97 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q3) | 0.1% | -0.2% | – |

| 20:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.1% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | CAD – GDP (MoM) (Aug) | 0.1% | 0.1% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Sep) | -2.0% | -5.0% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9990, 1.0095

Support level: 0.9905, 0.9810

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9930, 1.0005

Support level: 0.9860, 0.9785

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1663.15, 1678.70

Support level: 1648.45, 1635.45

281022 Morning Session Analysis

28 October 2022 Morning Session Analysis

Greenback revived as the economic data turned positive.

The dollar index, which traded against a basket of six major currencies, managed to find its ground as the U.S. data showed that the world’s biggest economy rebounded more than expected in the third quarter. According to the Bureau of Economic Analysis, the US GDP came in at 2.6% QoQ, higher than the consensus forecast at 2.4%, revealing a more upbeat snapshot of the economy even as high inflation is still the major challenge of the nation, just like any other country in the world. In fact, the GDP growth ticked upward because of a narrowing trade deficit in recent months. On top of that, the gains also occurred because of growth in consumer spending, government spending, and non-residential fixed investment. Despite the fact that the nation’s economic outlook remains clouded as the effect of rising interest rates is expected to come in soon, where exports will fade, and domestic demand is getting crushed. On the other side, the US Initial Jobless Claims data came in at 217K, lower than the consensus forecast at 220K, mirroring that the US labor market remains resilient. As of writing, the dollar index rose 0.78% to 110.55.

In the commodities market, crude oil prices edged up by 0.05% to $88.55 per barrel as the US GDP data showed a higher-than-expected reading, which boosted the market optimism toward the outlook of the oil demand. Besides, gold prices depreciated by -0.09% to $1661.85 per troy ounce following the rebound of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q3) | 0.1% | -0.2% | – |

| 20:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.1% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | CAD – GDP (MoM) (Aug) | 0.1% | 0.1% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Sep) | -2.0% | -5.0% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 110.00. However, MACD which illustrated bearish bias momentum suggest the index to undergo technical correction in short term.

Resistance level: 110.00, 111.70

Support level: 107.90, 105.00

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

EURUSD, Daily: EURUSD was traded lower following prior retracement near the resistance level at 1.0025. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9900.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.50. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.50, 150.15

Support level: 144.70, 141.65

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6530. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6400.

Resistance level: 0.6530, 0.6730

Support level: 0.6400, 0.6205

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5950.

Resistance level: 0.5950, 0.6105

Support level: 0.5770, 0.5560

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9840. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9935, 1.0050

Support level: 0.9840, 0.9720

CrudeOIL, Daily: Crude oil price was traded higher following prio breakout above the previous resistance level at 86.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 93.10.

Resistance level: 93.10, 98.15

Support level: 87.70, 81.45

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1660.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1677.80, 1695.25

Support level: 1660.90, 1638.40

271022 Afternoon Session Analysis

27 October 2022 Afternoon Session Analysis

Euro surged upon aggressive rate hike expectations.

The EUR/USD, which traded by majority of investors rose significantly on yesterday amid the rate hike expectation from European Central Bank (ECB). According to Reuters, the ECB was anticipated to hike its interest rate by today in order to stabilize the sky-high inflationary risk, which 75 basis point rate increase would likely to be implemented in the meeting tonight. Fearing that spiking price is becoming worse, the ECB has raised its rates at the fastest pace on record as well as the rate hike path could take it well into next year or beyond. Besides, ECB also hinted that the process of tightening monetary policy is not yet done, and the size of subsequent moves still on the table. Such hawkish stance had sparked the appeal of Euro. As of now, investors would highly eye on the announcement of ECB interest rate decision to gauge the likelihood movement of Euro. On the other hand, the EUR/USD pairing extended its gains over the depreciation of US Dollar, which led by diminishing expectation of aggressive rate hike from Fed. As of writing, EUR/USD edged down by 0.06% to 1.0071.

In the commodities market, the crude oil price appreciated by 0.27% to $88.17 per barrel as of writing as record-high US crude exports suggested that global oil demand remained robust despite recent economic headwinds. In addition, the gold price eased by 0.01% to $1664.74 per troy ounce as of writing following the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Oct) | 0.75% | 1.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 1.50% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Oct) | 1.25% | 2.00% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Sep) | 0.3% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q3) | -0.6% | 2.4% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 220K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 109.95, 111.55

Support level: 108.45, 107.05

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0095, 1.0245

Support level: 0.9990, 0.9905

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6705

Support level: 0.6470, 0.6370

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9860, 0.9930

Support level: 0.9785, 0.9685

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1678.70, 1693.20

Support level: 1663.15, 1648.45

271022 Morning Session Analysis

27 October 2022 Morning Session Analysis

Greenback slumped as the possibility of an aggressive rate hike was reduced.

The dollar index, which traded against a basket of six major currencies, sank more than 1%, as weakening economic data reaffirmed the market views that the Federal Reserve may slow the pace of its rate hiking cycle, while sending the euro back above parity with the greenback for the first time in a month. The dollar’s decline came as the benchmark 10-year U.S. Treasury yield continued its descent from last week’s multi-year high of 4.338%, and was last down four basis points at 4.0317%. However, the market participants are waiting for other crucial economic data to further scrutinize whether the Federal Reserve would slow down its pace of rate hike in the upcoming meeting. Some other data would be the US GDP and US Initial Jobless Claims, which scheduled to be announced later today. On the other side, the appointment of new prime minister in UK also boosted the investor’s optimism in pound market, while dragging the value of the dollar index to a lower level. As of writing, the dollar index slumped -1.09% to 108.75.

In the commodities market, crude oil prices edged down by -0.06% to $89.15 per barrel despite the EIA Crude Oil inventories data shows some stockpile over the week. In the matter of fact, the jump in crude oil price was attributable to the weakening of dollar index. Besides, gold prices appreciated 0.04% to $1665.40 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Oct) | 0.75% | 1.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 1.50% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Oct) | 1.25% | 2.00% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Sep) | 0.3% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q3) | -0.6% | 2.4% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 220K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 110.00. MACD which illustrated bearish bias momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 111.70, 113.10

Support level: 110.00, 107.90

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0025. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0130.

Resistance level: 1.0130, 1.0370

Support le vel: 1.0025, 0.9900

vel: 1.0025, 0.9900

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 147.50. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 150.15, 152.50

Support level: 147.50, 144.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6400, 0.6530

Support level: 0.6205, 0.5990

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.5770, 0.5950

Support level: 0.5560, 0.5400

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9935. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0050, 1.0150

Support level: 0.9935, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 86.70. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 86.70.

Resistance level: 86.70, 93.10

Support level: 81.45, 76.85

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1660.90. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo short term technical correction.

Resistance level: 1677.80, 1695.25

Support level: 1660.90, 1638.40

261022 Afternoon Session Analysis

26 October 2022 Afternoon Session Analysis

Euro jumped as economic data showed an expansion in Germany.

The EUR/USD, which traded by majority of investors rallied significantly on yesterday amid the economic data which better-than-expectation. According to Ifo Institute for Economic Research, the Germany Ifo Business Climate Index in October came in at the reading of 84.3, exceeding the consensus forecast of 83.3. Such data had given a sign of economic expansion in German, which brought positive prospects toward economic progression in Eurozone as Germany was the largest economy in Europe. On the other hand, the USD/CAD dropped significantly on yesterday as Bank of Canada (BoC) was expected to announce another hefty rate hike on Wednesday. As of now, the market participants are anticipating that third-quarter of a percentage point rate increase would be implemented by BoC. Though, the rate hike pace might be slow down after the rate hike announcement as the sky-high inflation risk in Canada has started to diminish. Starting from July, the Canada CPI has lowered from 8.1% to the current 6.9%. As of writing, the EUR/USD depreciated by 0.04% to 0.9960 while USD/CAD eased by 0.03% to 1.3601.

In the commodities market, the crude oil price depreciated by 0.60% to $84.81 per barrel as of writing. Nonetheless, the oil price was rose for more than $1 per barrel on yesterday over the weakening dollar has dialed up the demand of this black commodity. In addition, the gold price appreciated by 0.15% to $1656.27 per troy ounce as of writing following the value of US Dollar depreciated.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – New Home Sales (Sep) | 685K | 585K | – |

| 22:00 | CAD – BoC Interest Rate Decision | 3.25% | 4.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.725M | 1.029M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9990, 1.0095

Support level: 0.9905, 0.9810

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5805, 0.5920

Support level: 0.5725, 0.5635

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1663.15, 1678.70

Support level: 1648.45, 1635.45

261022 Morning Session Analysis

26 October 2022 Morning Session Analysis

Greenback plunged amid the release of downbeat economic data.

The dollar index, which traded against a basket of six major currencies, sagged after a downbeat economic data was released, whereby the result of the data against the market optimism. According to the Conference Board, the US CB Consumer Confidence data came in at 102.5, far lower than the consensus forecast at 106.5, mirroring that the consumer confidence in economic activity deteriorated. With that, it may urge the Federal Reserve to adjust the cash rate conservatively, says 50 basis point in the upcoming meeting. On the other side, the greenback received further sell-off pressures after Rishi Sunak becomes the new prime minister. The Sterling rallied to a six-week high on Tuesday on improved risk sentiment as Rishi Sunak became Britain’s prime minister. Rishi Sunak became Britain’s third prime minister in two months on Tuesday, tasked with tackling a mounting economic crisis and a warring political party. As Rishi Sunak is tilted toward increasing tax and reducing government spending, the market participants take him as someone who can save the UK economy from recession and stabilize the financial market going forward. As of writing, the dollar index dropped -0.88% to 111.00.

In the commodities market, crude oil prices edged down by -0.09% to $84.85 per barrel as the API data shows some stockpile over the week. According to the API, the US crude oil inventories data came in at 4.520M, higher than the consensus forecast at 0.200M. Besides, gold prices appreciated 0.07% to $1652.15 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – New Home Sales (Sep) | 685K | 585K | – |

| 22:00 | CAD – BoC Interest Rate Decision | 3.25% | 4.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.725M | 1.029M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.70. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 110.00.

Resistance level: 111.70, 113.10

Support level: 110.00, 107.90

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1470. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1470, 1.1620

Support level: 1.1300, 1.1150

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9900. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 147.50. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 150.15, 152.50

Support level: 147.50, 144.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6400, 0.6530

Support level: 0.6205, 0.5990

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.5770, 0.5950

Support level: 0.5560, 0.5400

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9935. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0050, 1.0150

Support level: 0.9935, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 81.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 86.70.

Resistance level: 86.70, 93.10

Support level: 81.45, 76.85

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1660.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1638.40.

Resistance level: 1660.90, 1677.80

Support level: 1638.40, 1615.40