251022 Afternoon Session Analysis

25 October 2022 Afternoon Session Analysis

Yen slipped as BOJ seen keeping ultra-low rates.

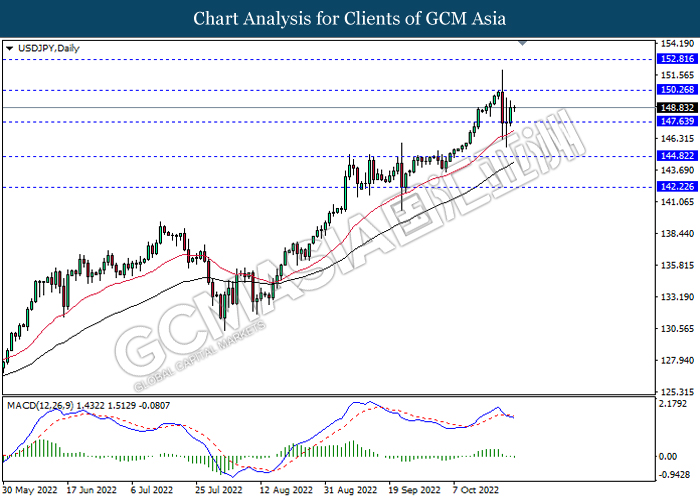

The USD/JPY which widely traded by global investors rebounded after the sharp decline on Friday amid the intervention from Bank of Japan (BoJ). According to Reuters, the Japanese currency temporarily surged by more than 7% against US Dollar, as the government and the BoJ made an unannounced intervention in the foreign exchange market. Over $33.6 billion has been sold by BoJ in order to support Yen, reported by The Financial Times. Though, the overall trend of USD/JPY remained bullish following the BoJ was anticipated to maintain its ultra-low interest rate. Although BoJ is expected to raise inflation forecast on Friday, but it would likely to keep negative rates to support the fragile economy. On the other hand, 75 basis point rate hike from Fed was expected by majority of investors, causing the interest rate differential of BoJ and Fed become wider, which prompting investors to flee away from Japanese currency market and purchase US Dollar. As of writing, the USD/JPY depreciated by 0.10% to 148.80.

In the commodities market, the crude oil price appreciated by 0.40% to $84.93 per barrel as of writing amid the expectation of output cut from OPEC+ which would start from November. In addition, the gold price edged up by 0.12% to $1651.78 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Oct) | 84.3 | 83.3 | – |

| 22:00 | USD – CB Consumer Confidence (Oct) | 108.0 | 106.5 | – |

Technical Analysis

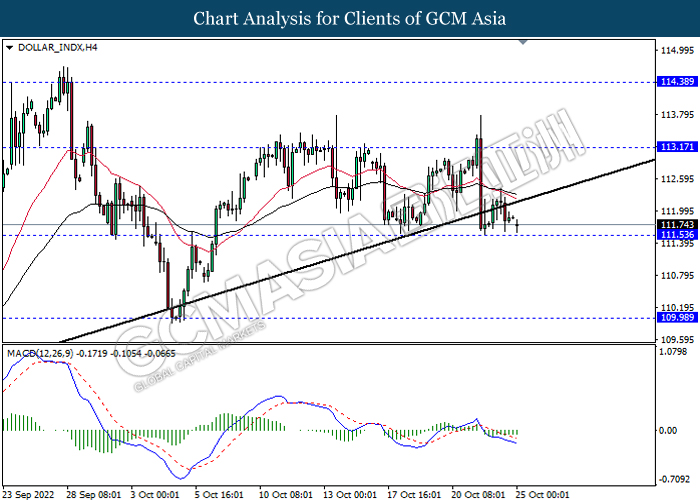

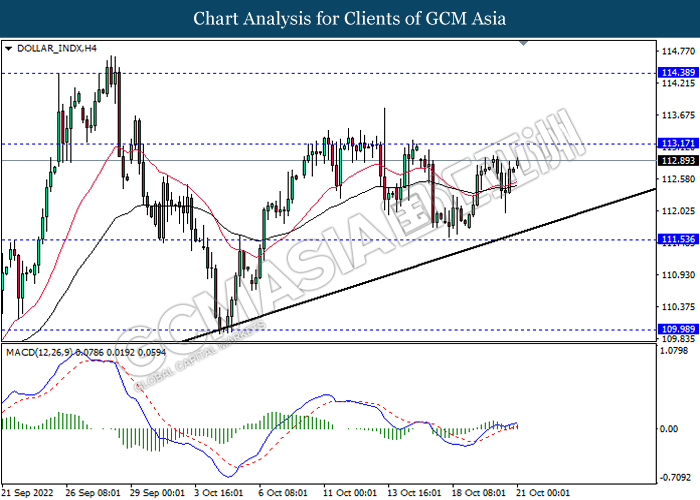

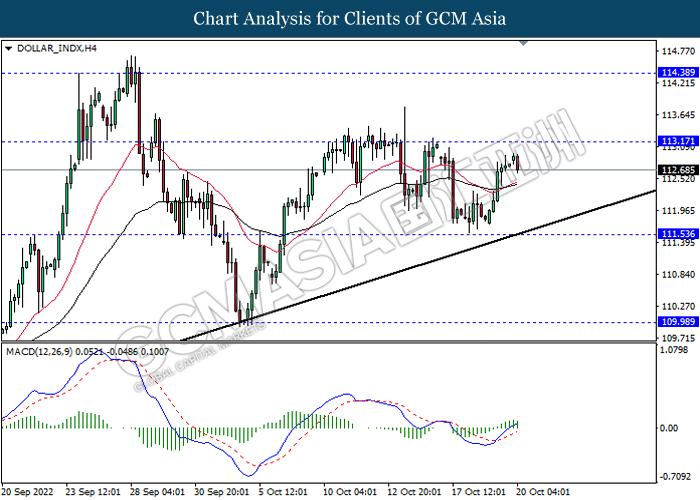

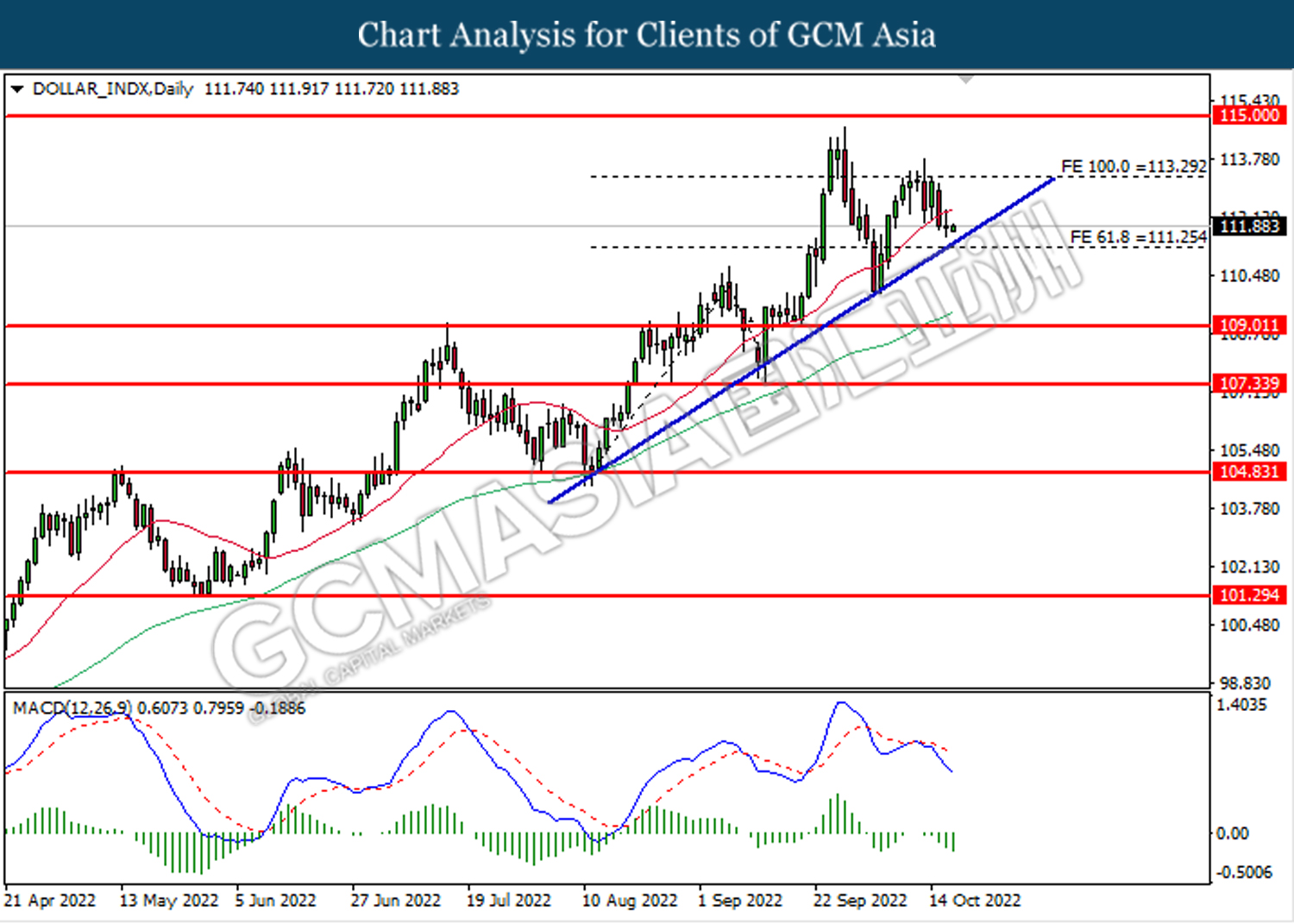

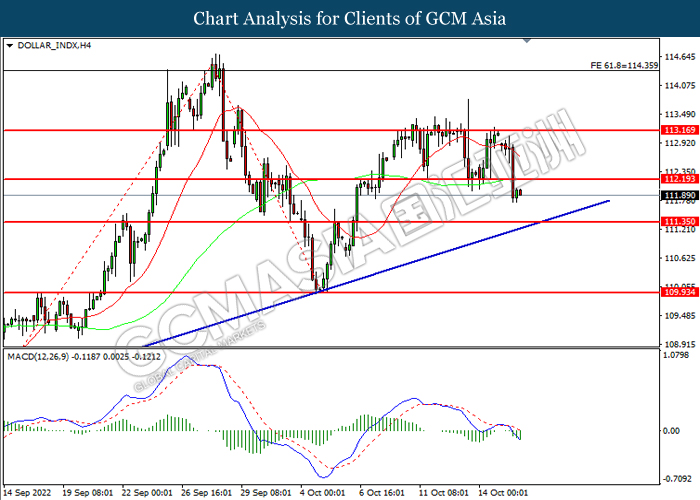

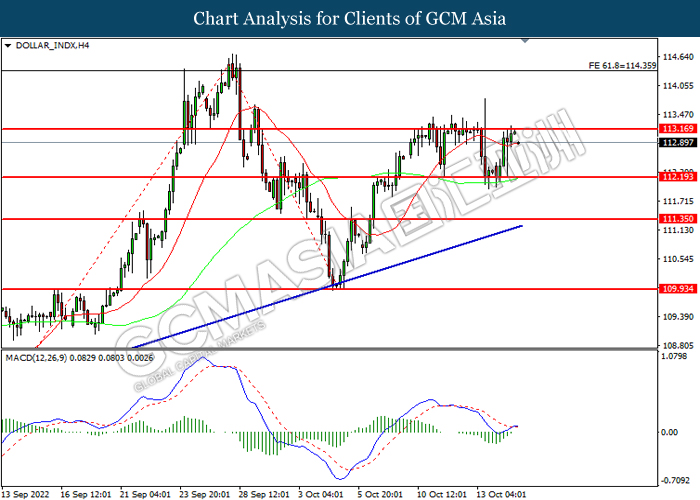

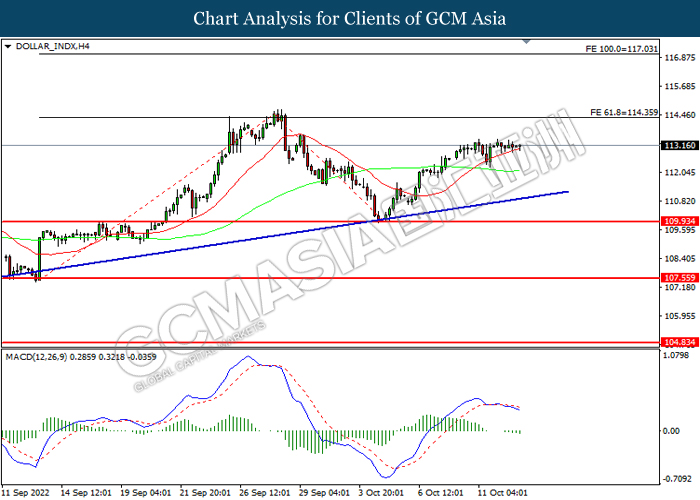

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 113.15, 114.40

Support level: 111.55, 109.95

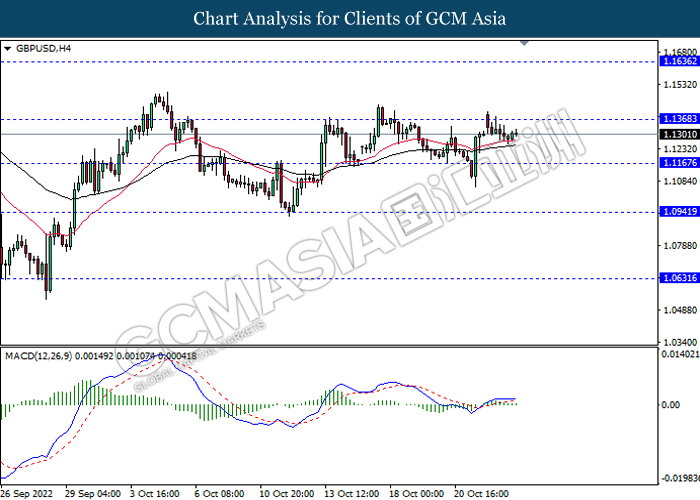

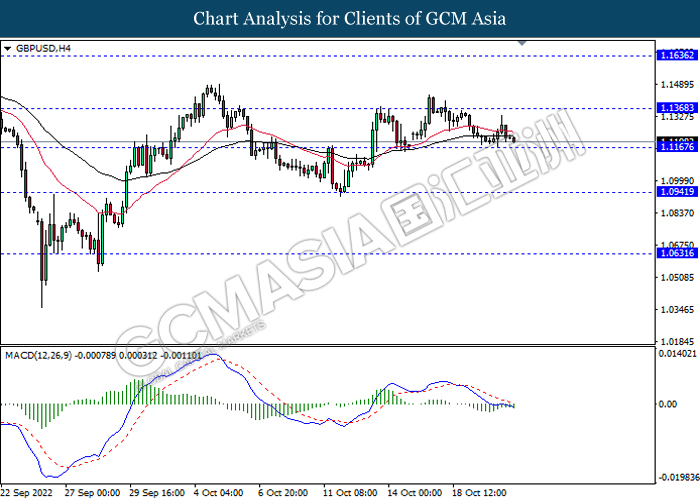

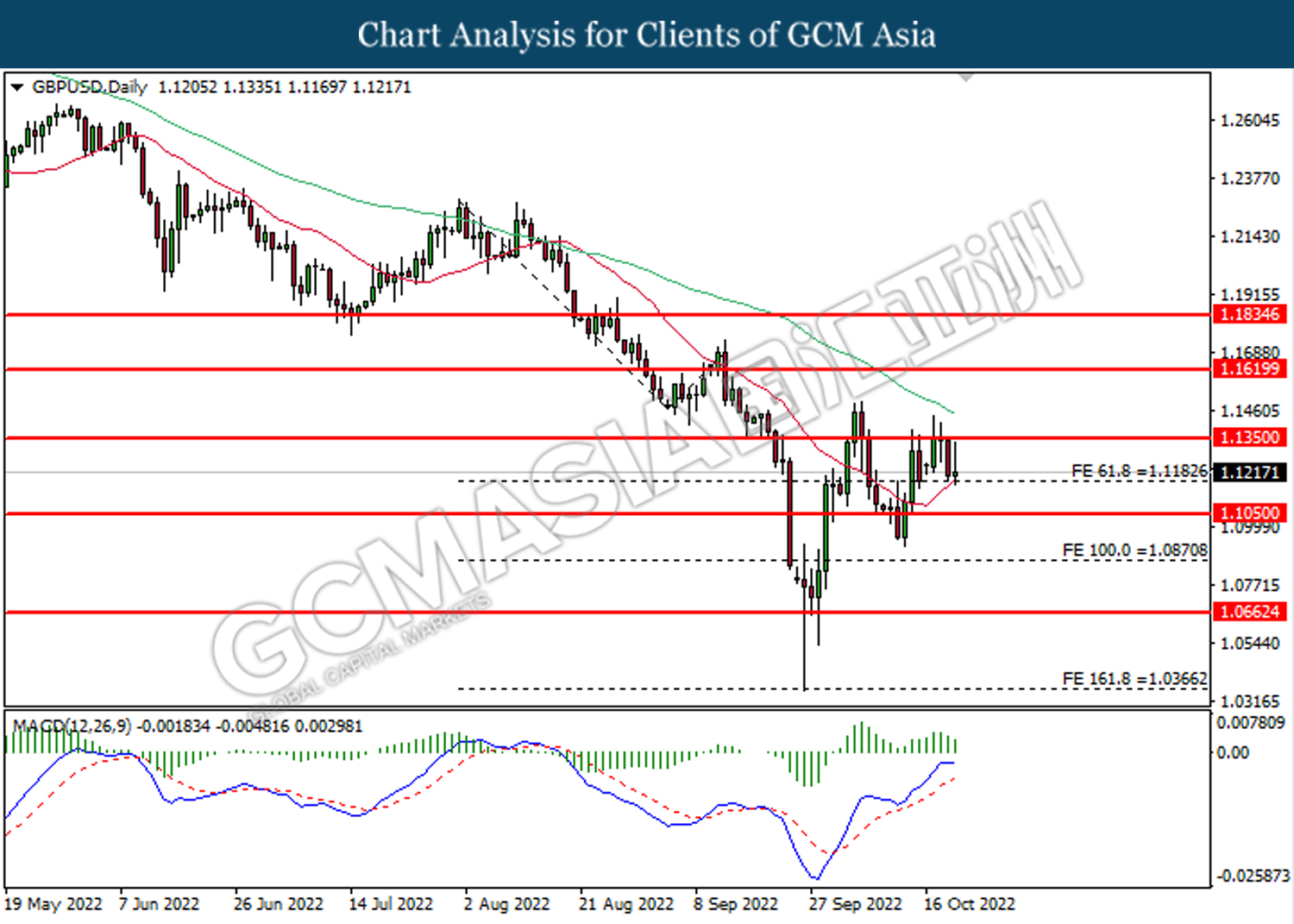

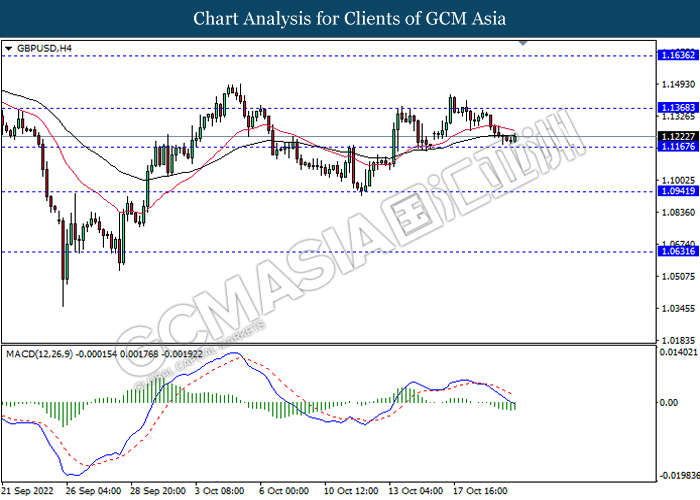

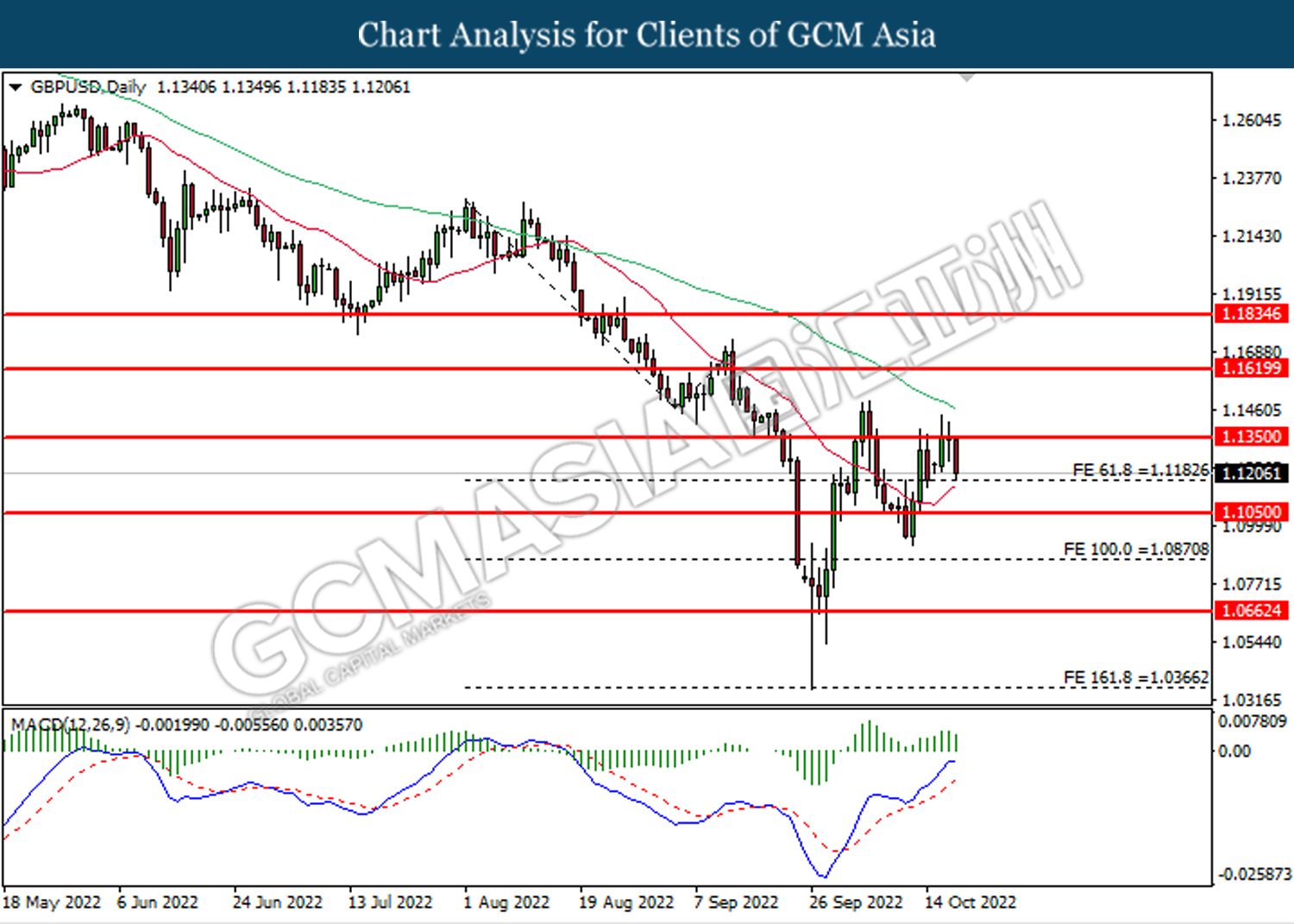

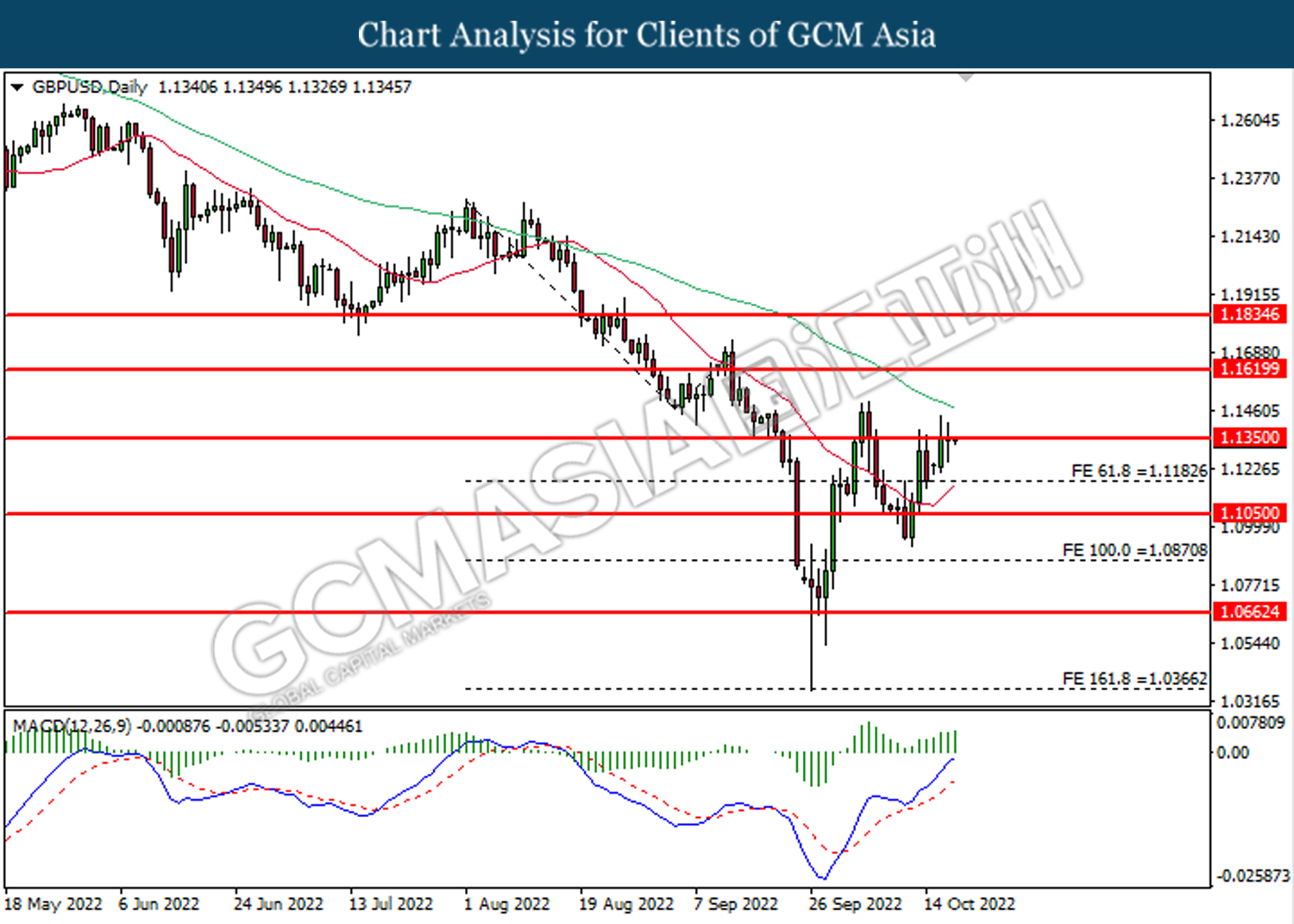

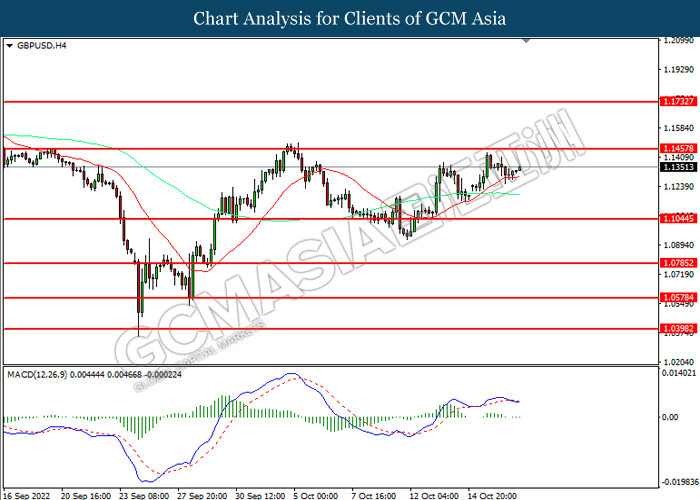

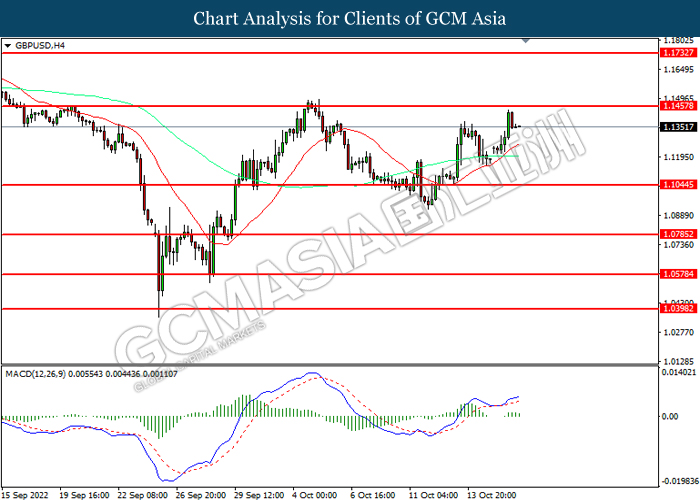

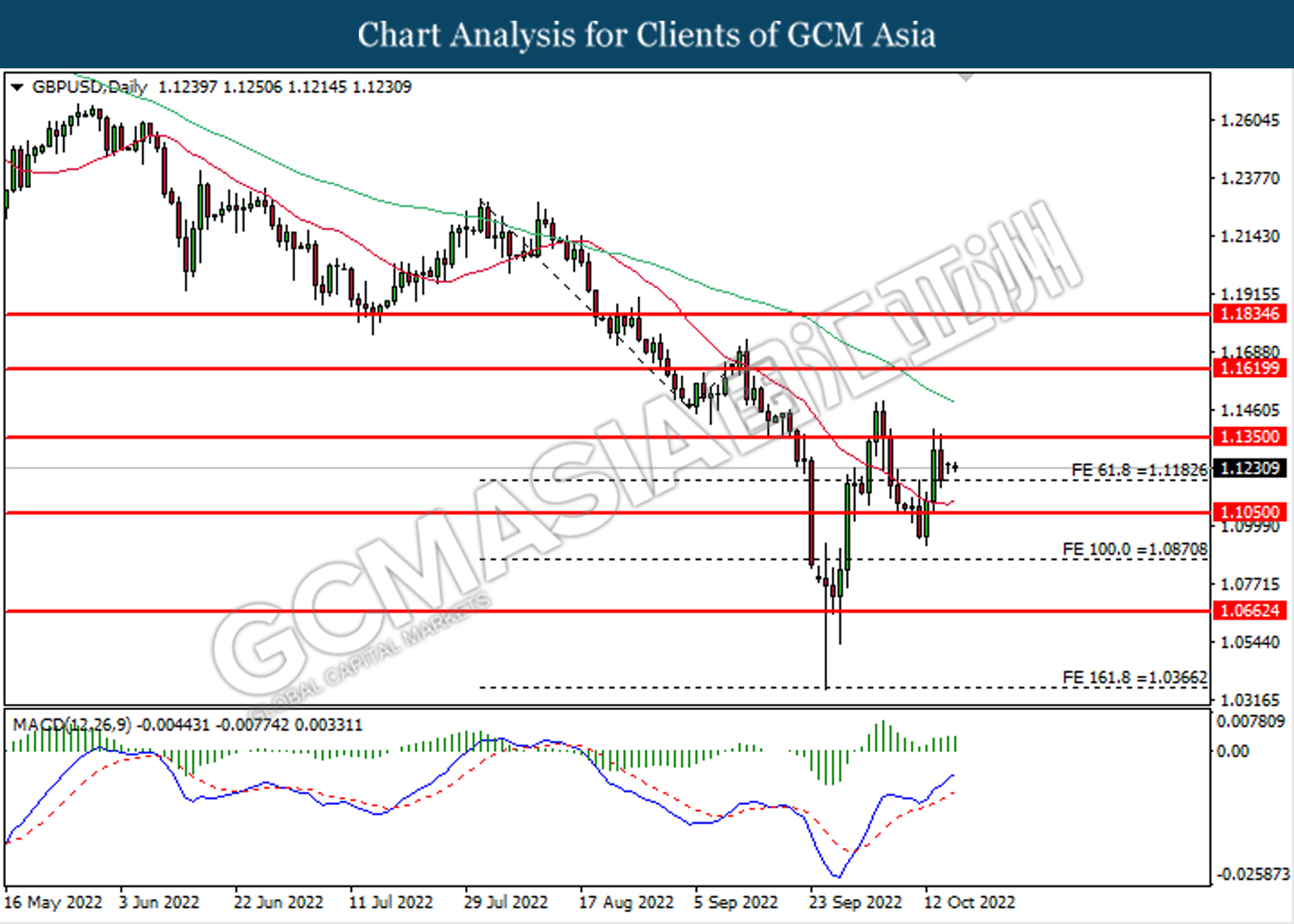

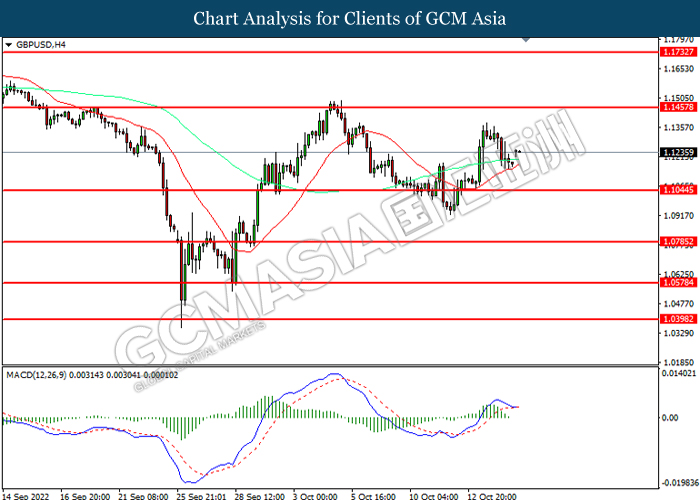

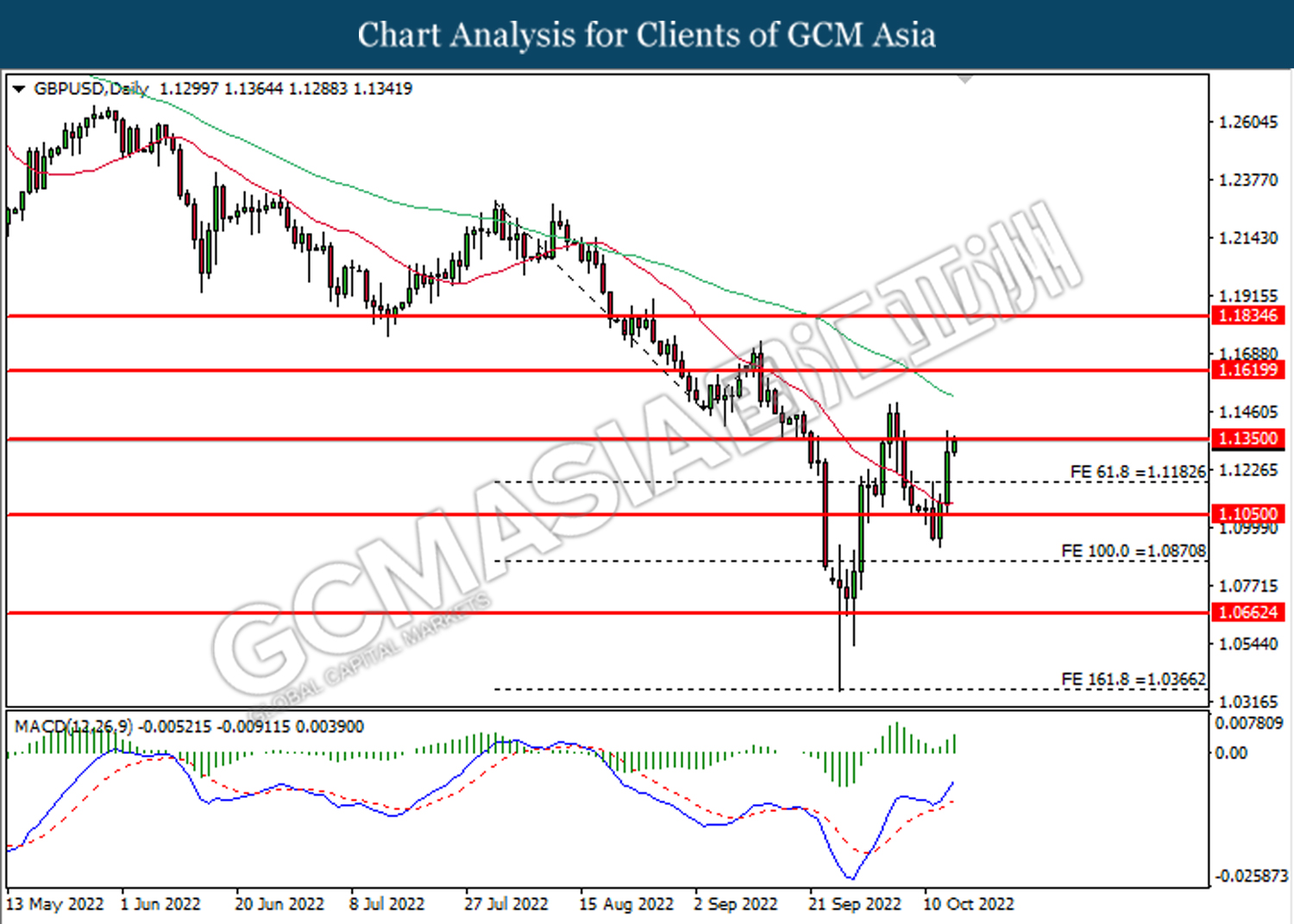

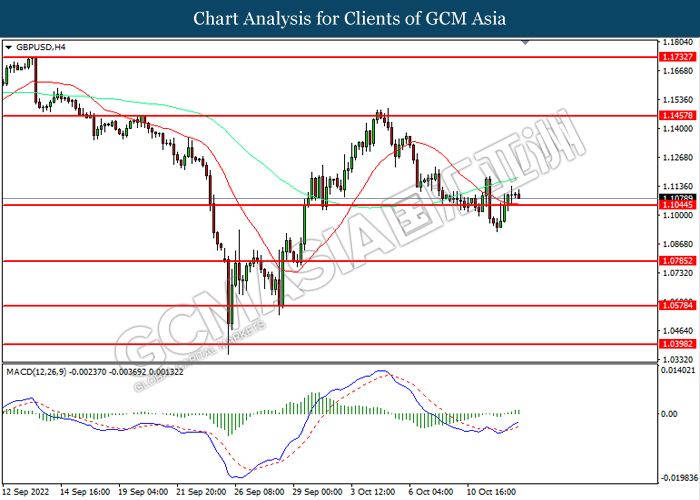

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

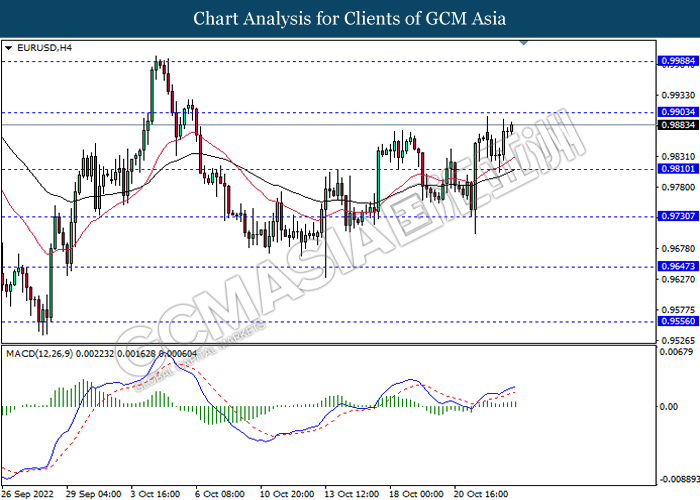

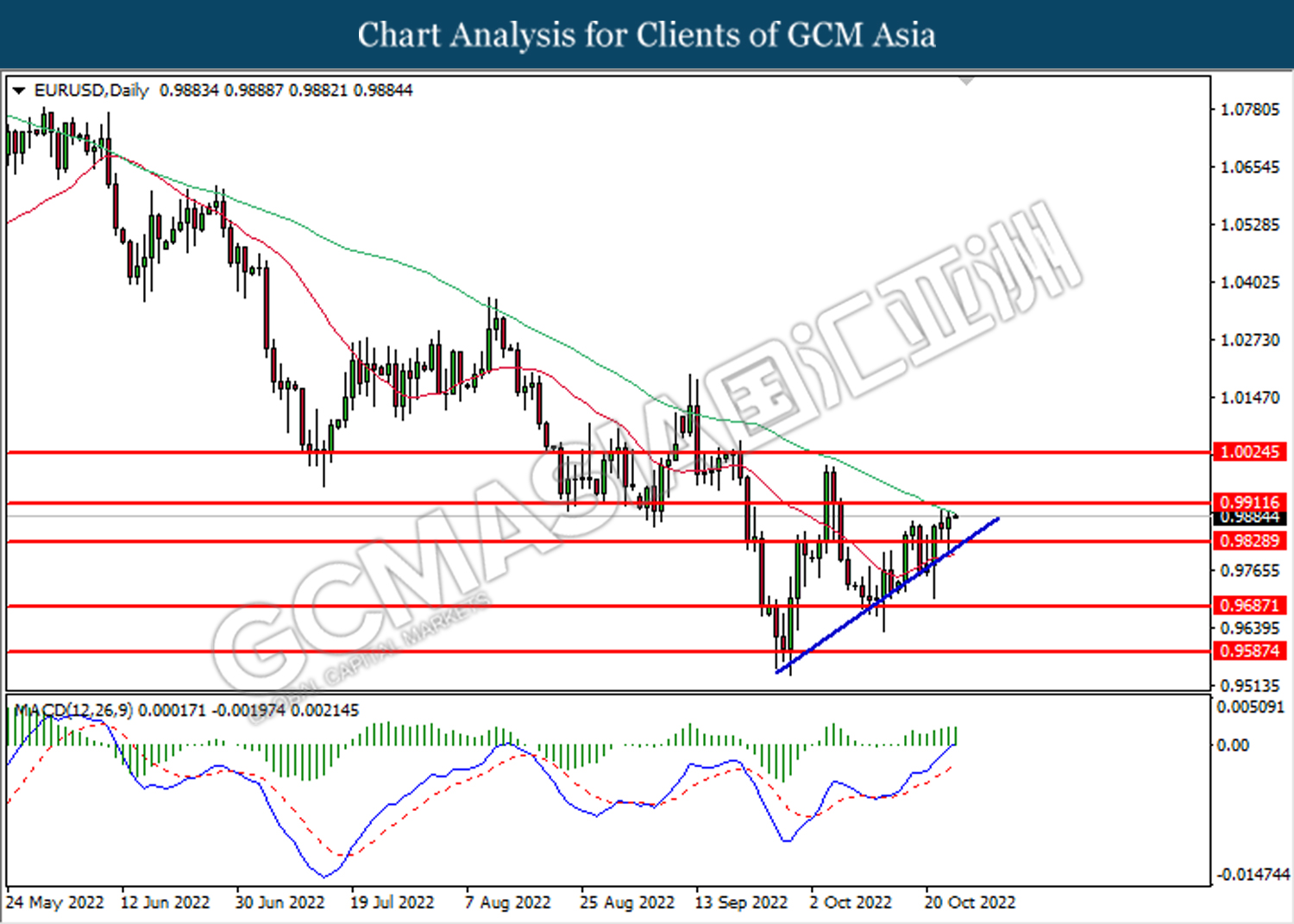

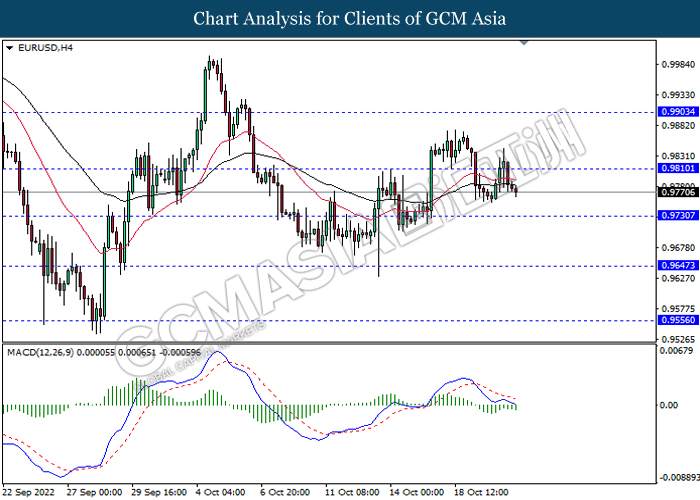

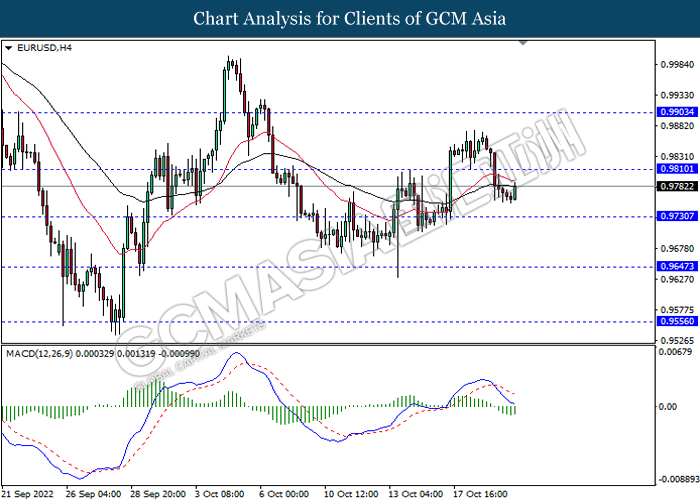

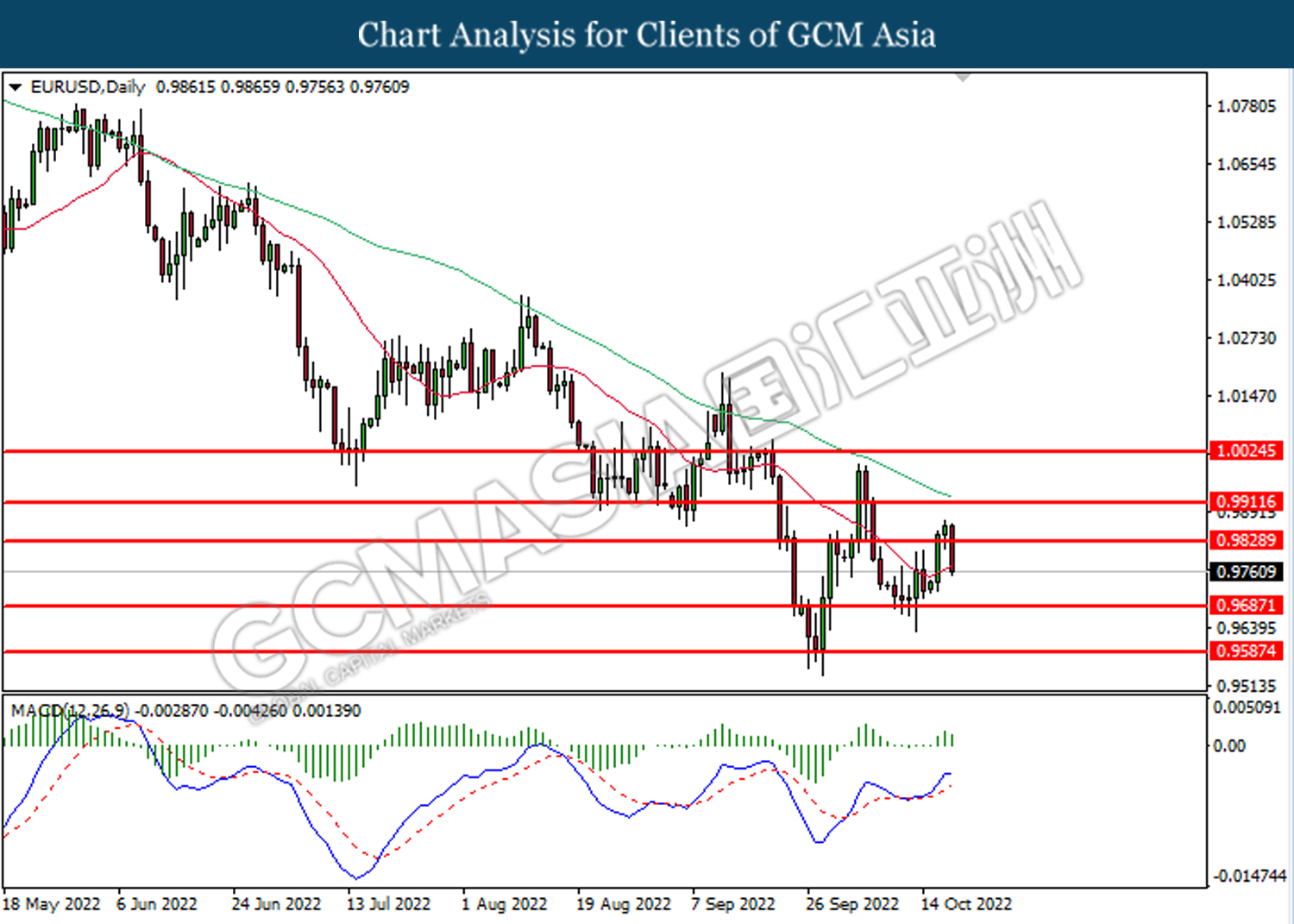

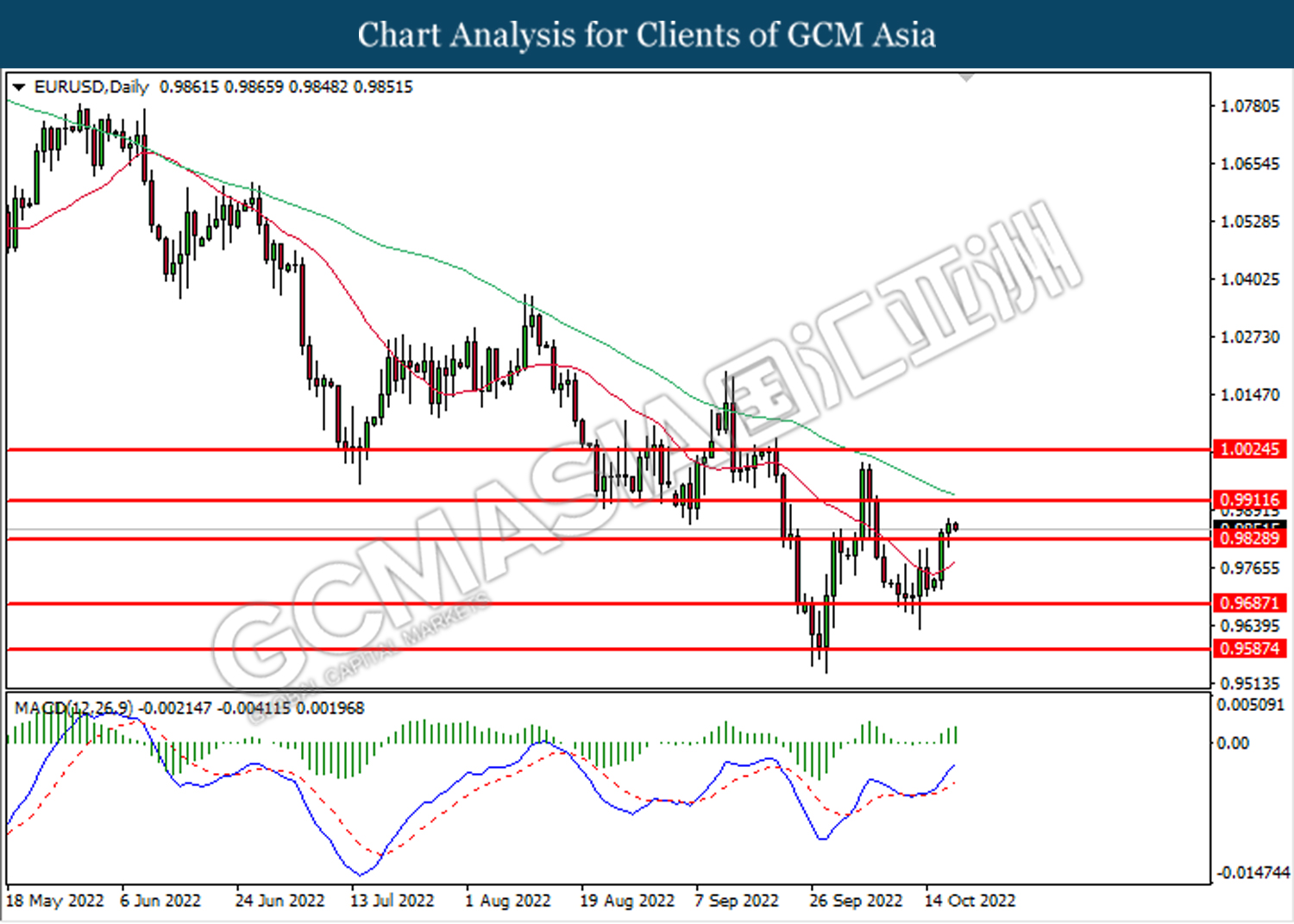

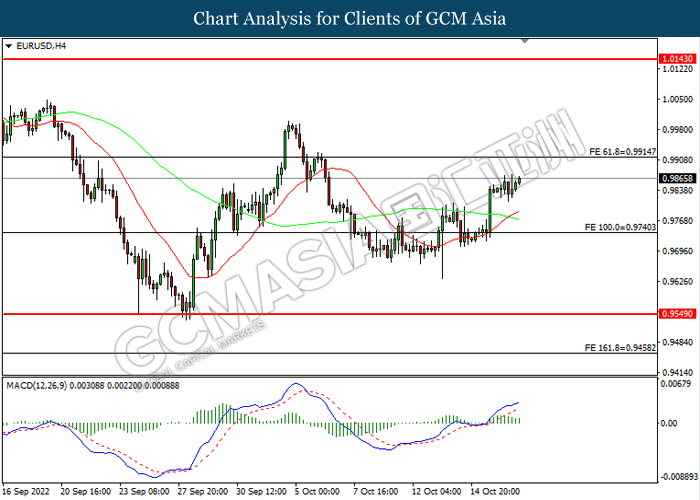

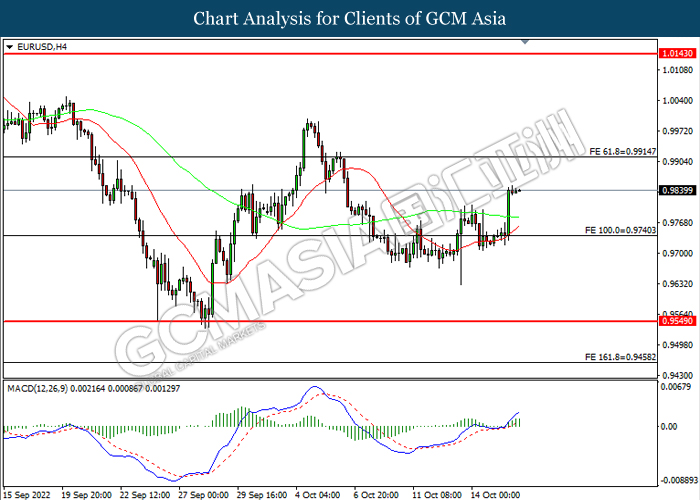

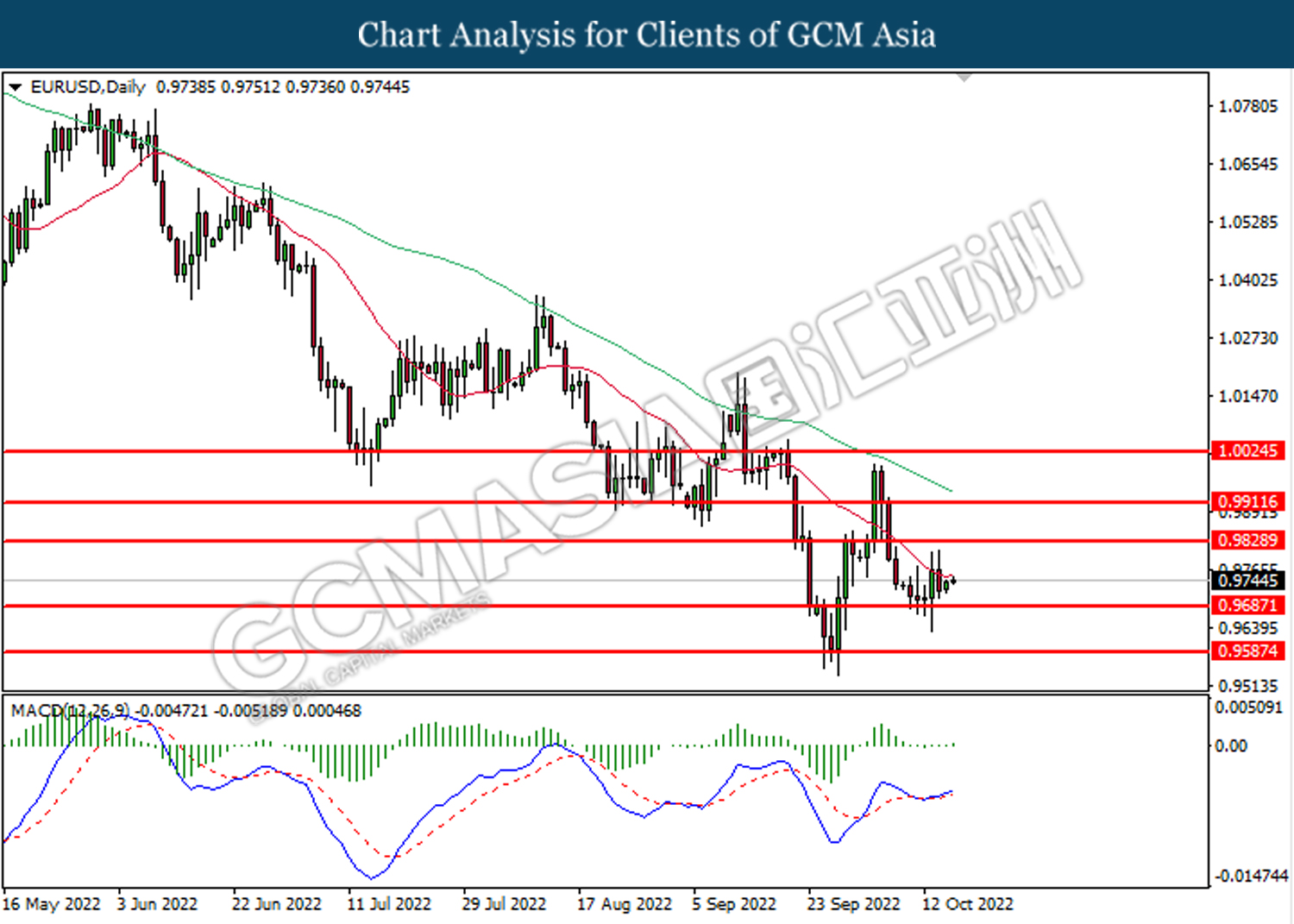

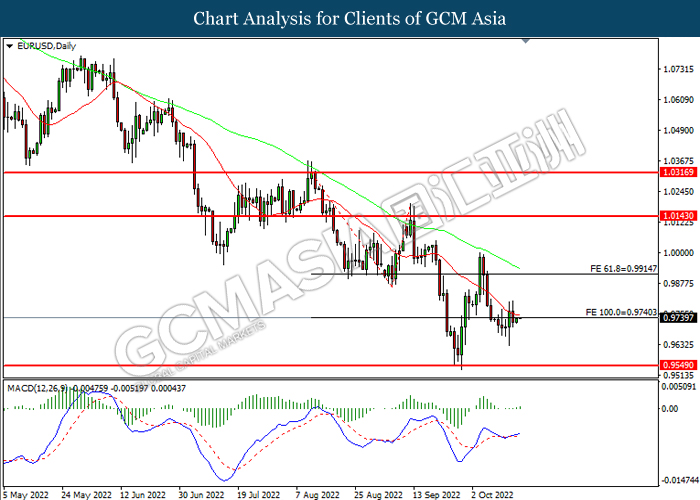

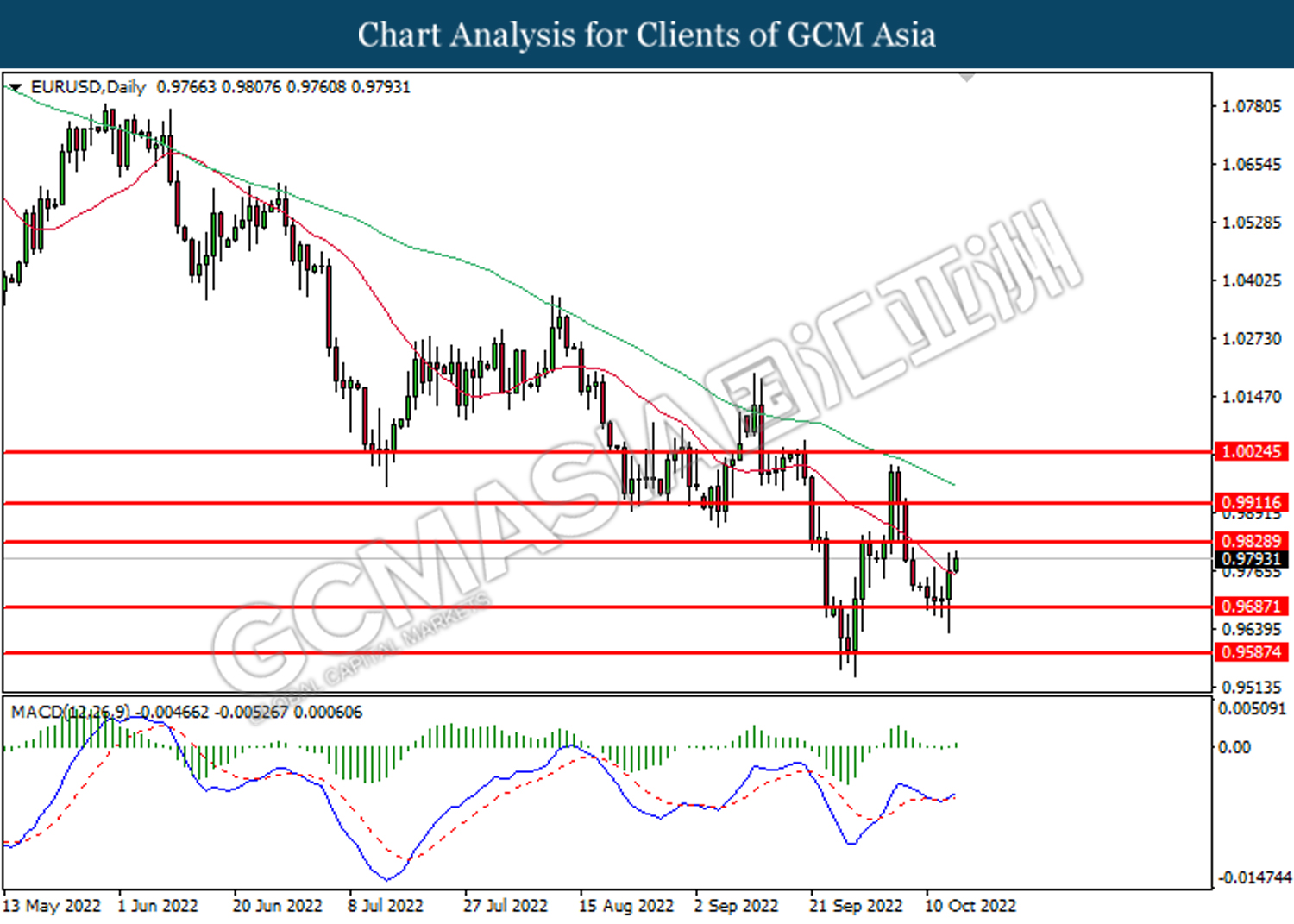

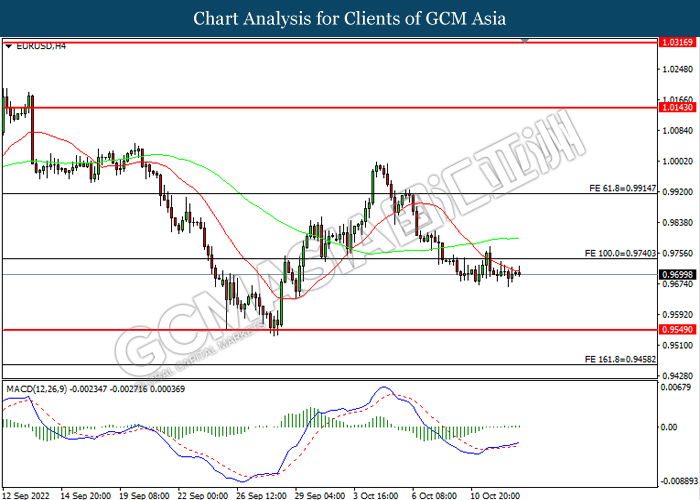

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

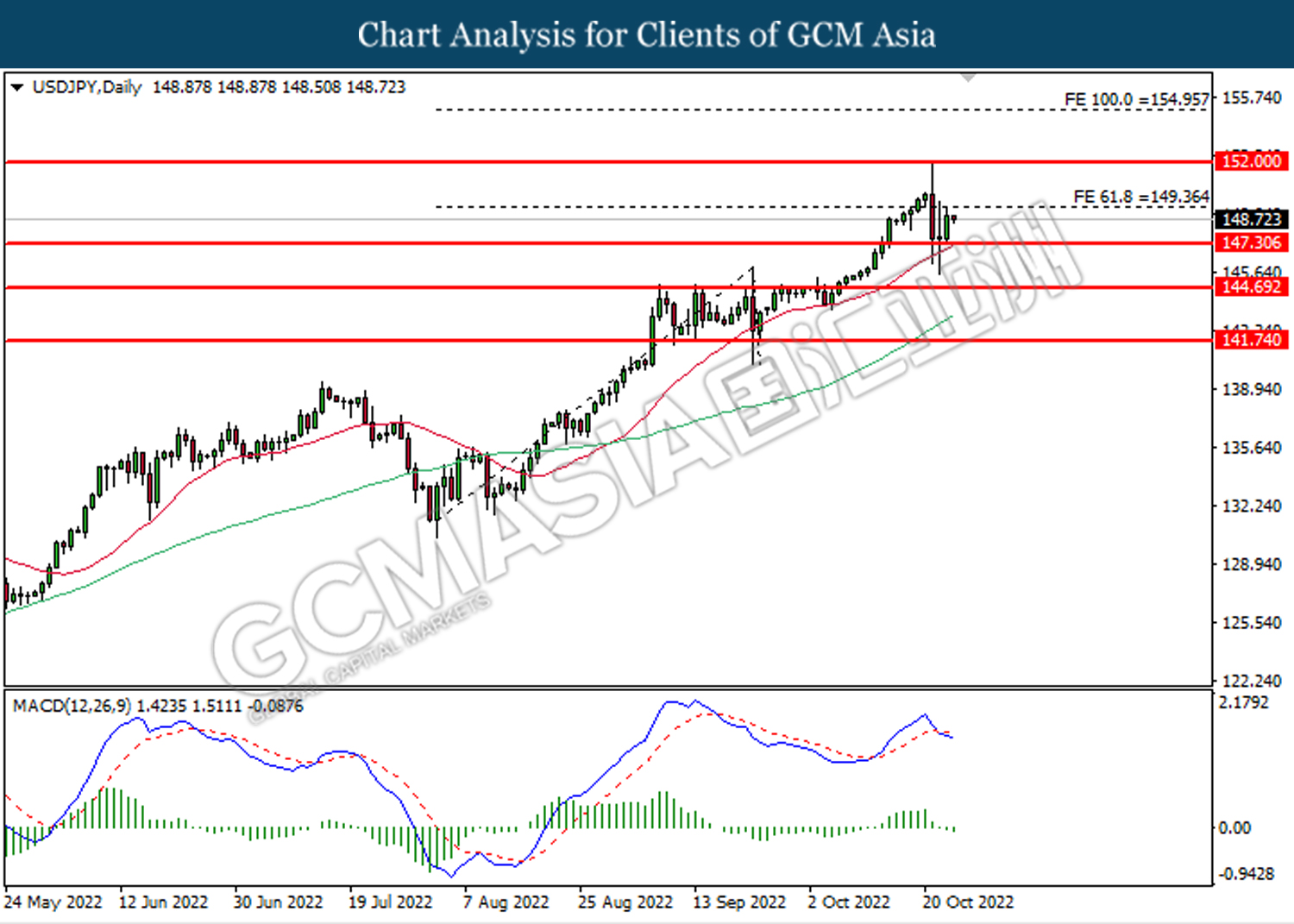

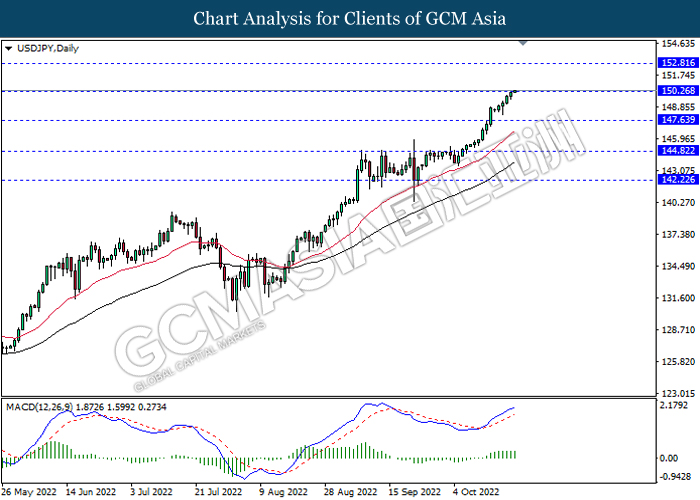

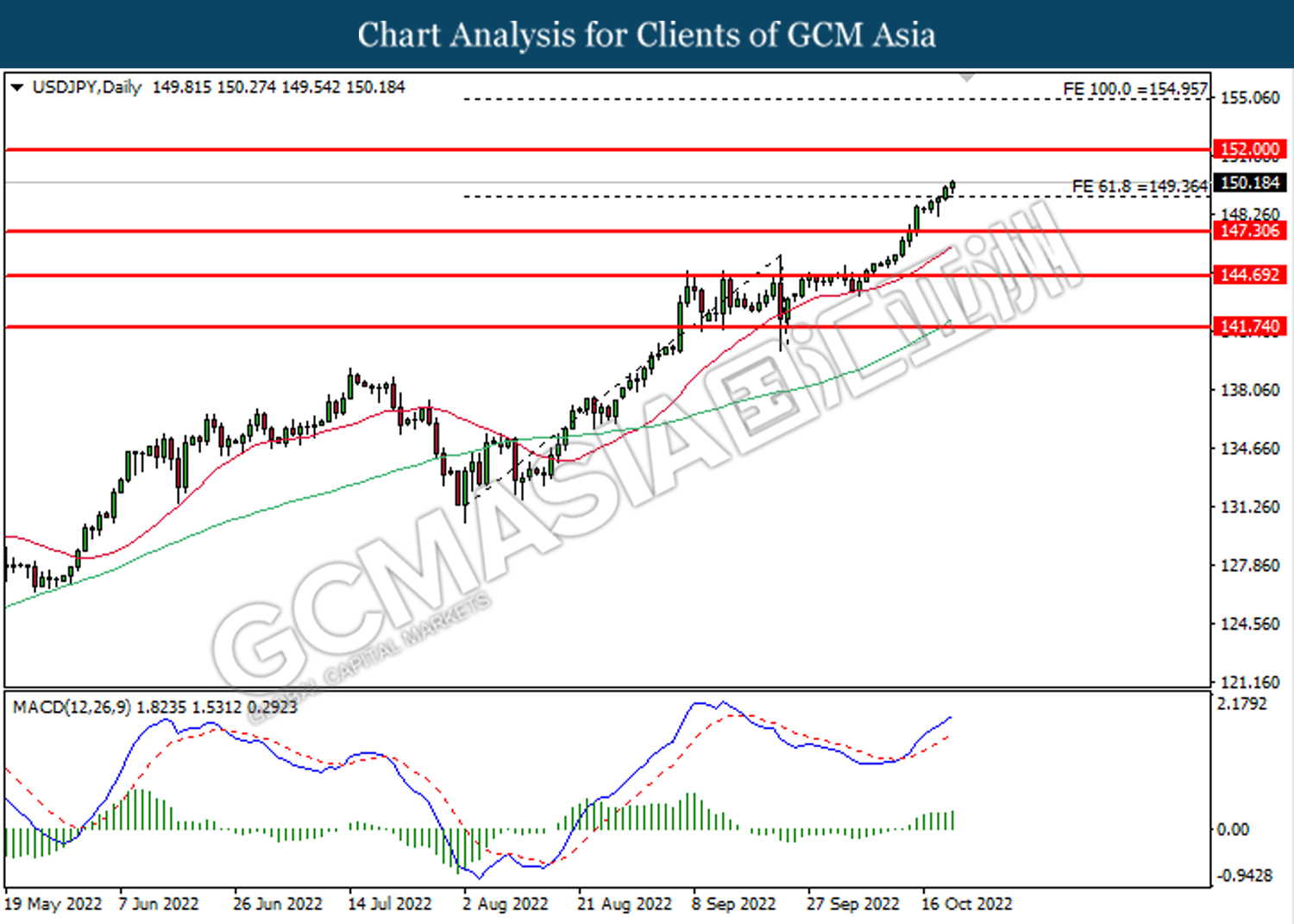

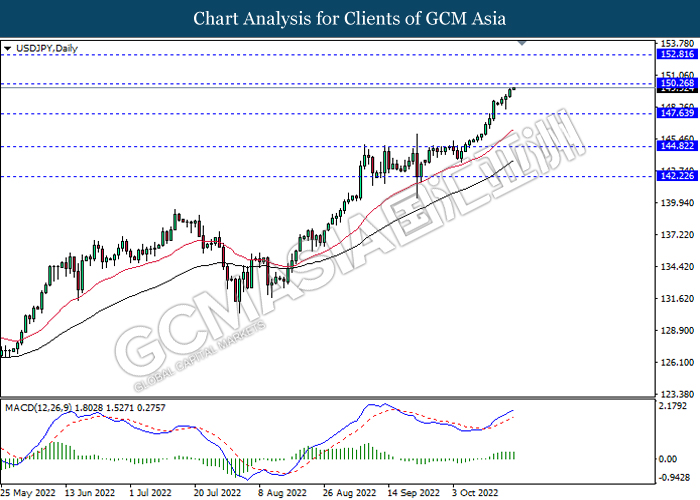

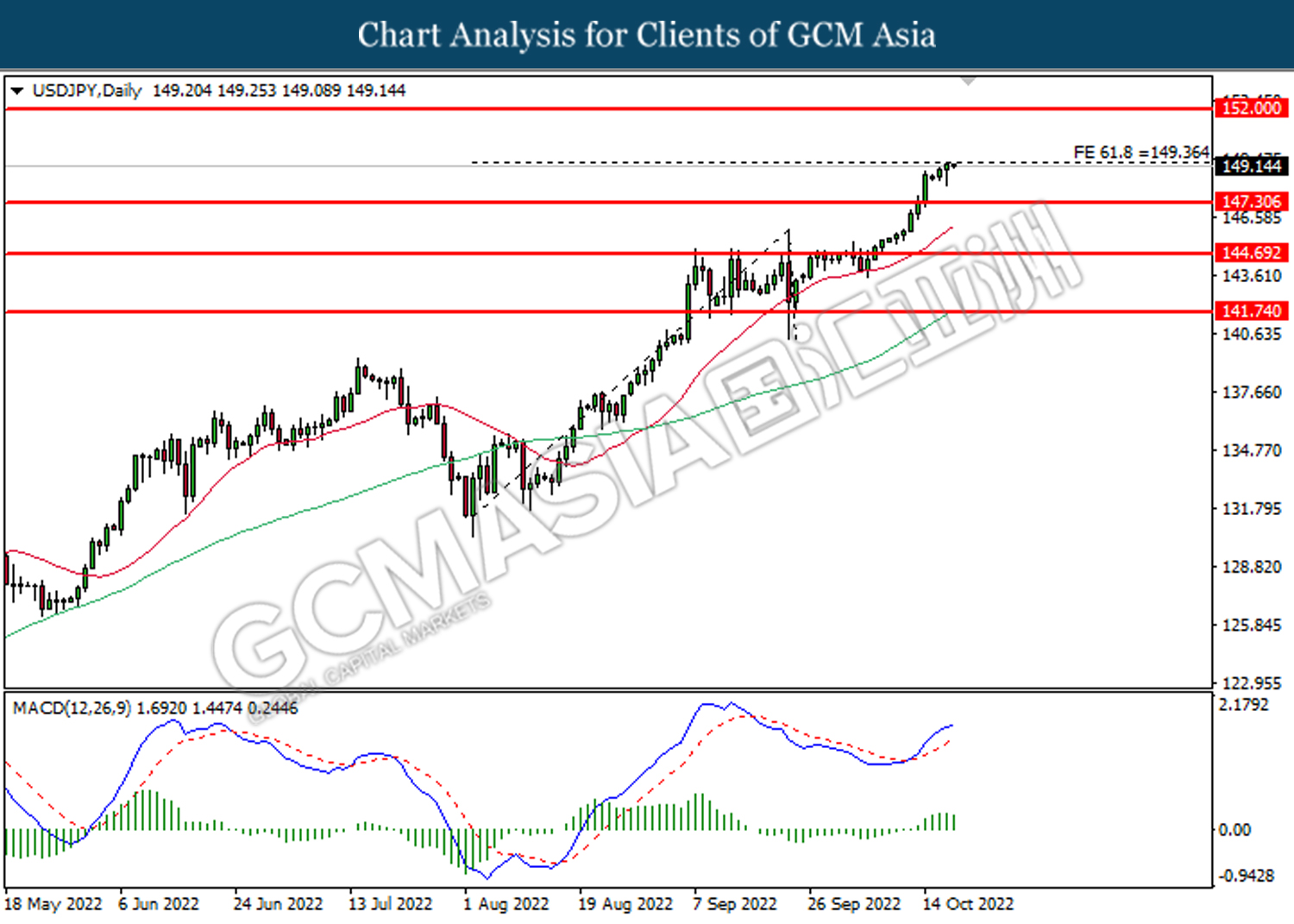

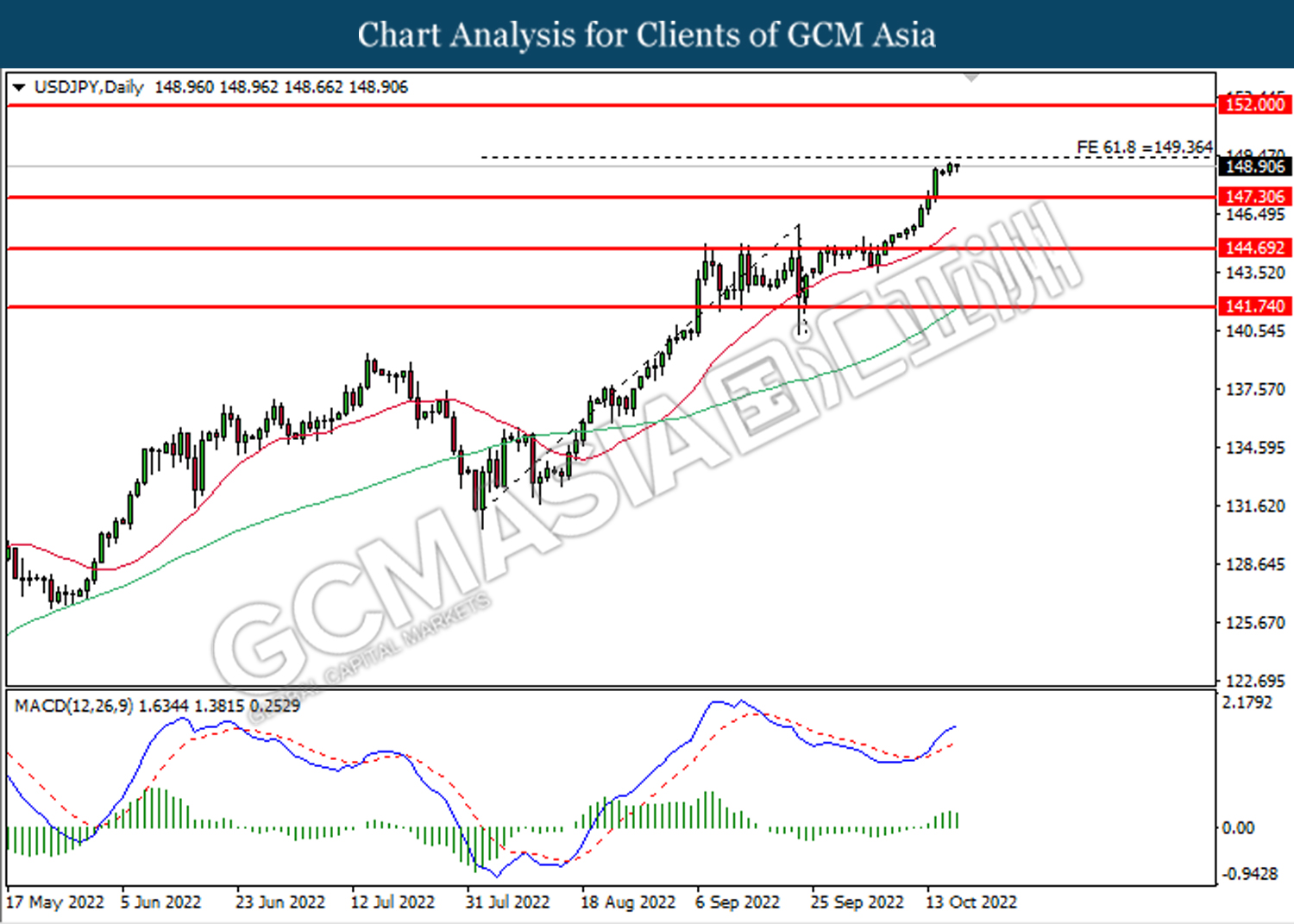

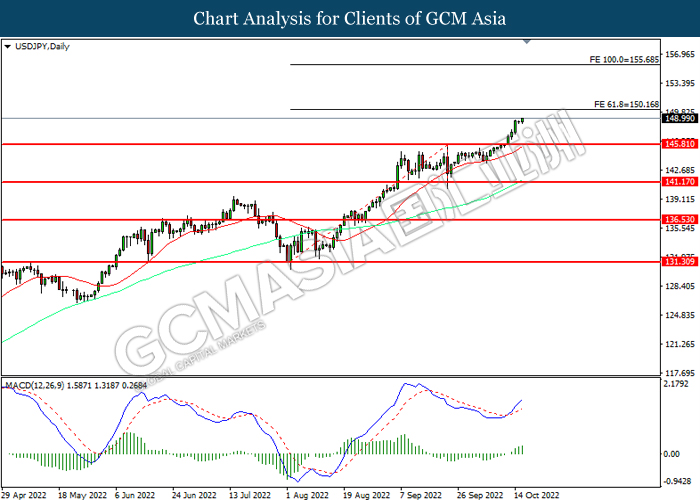

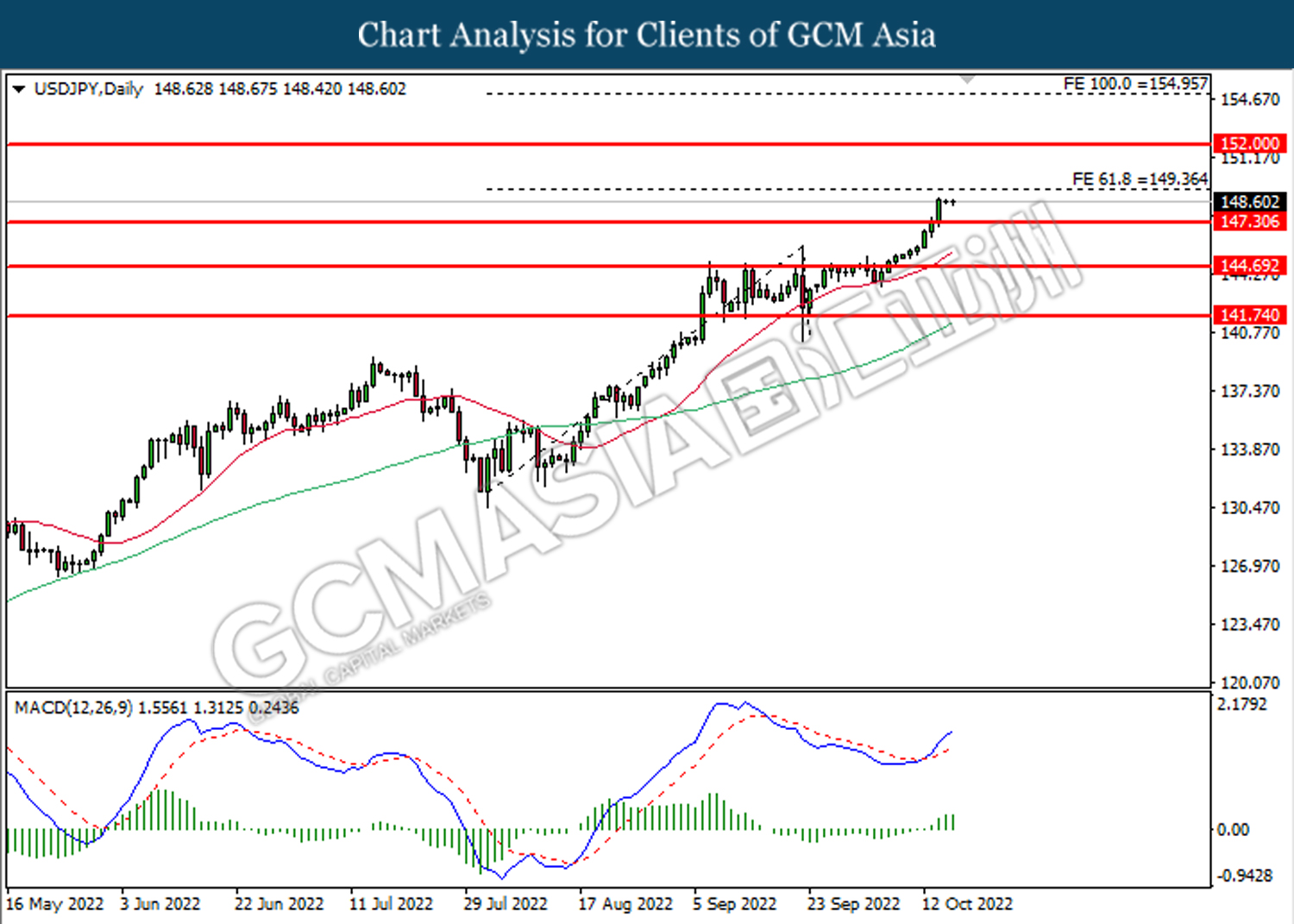

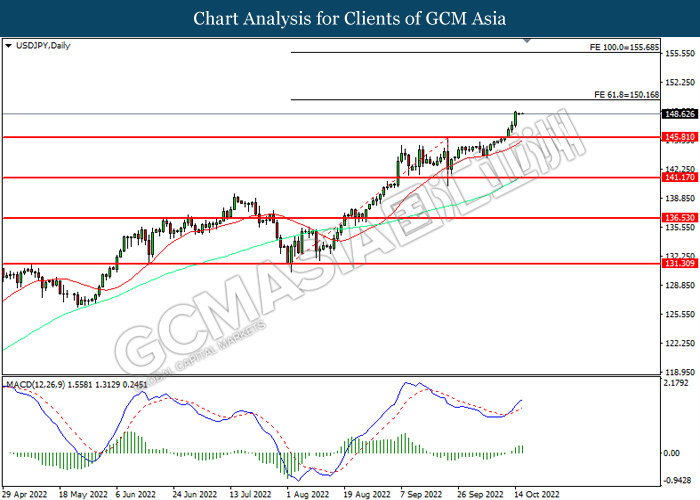

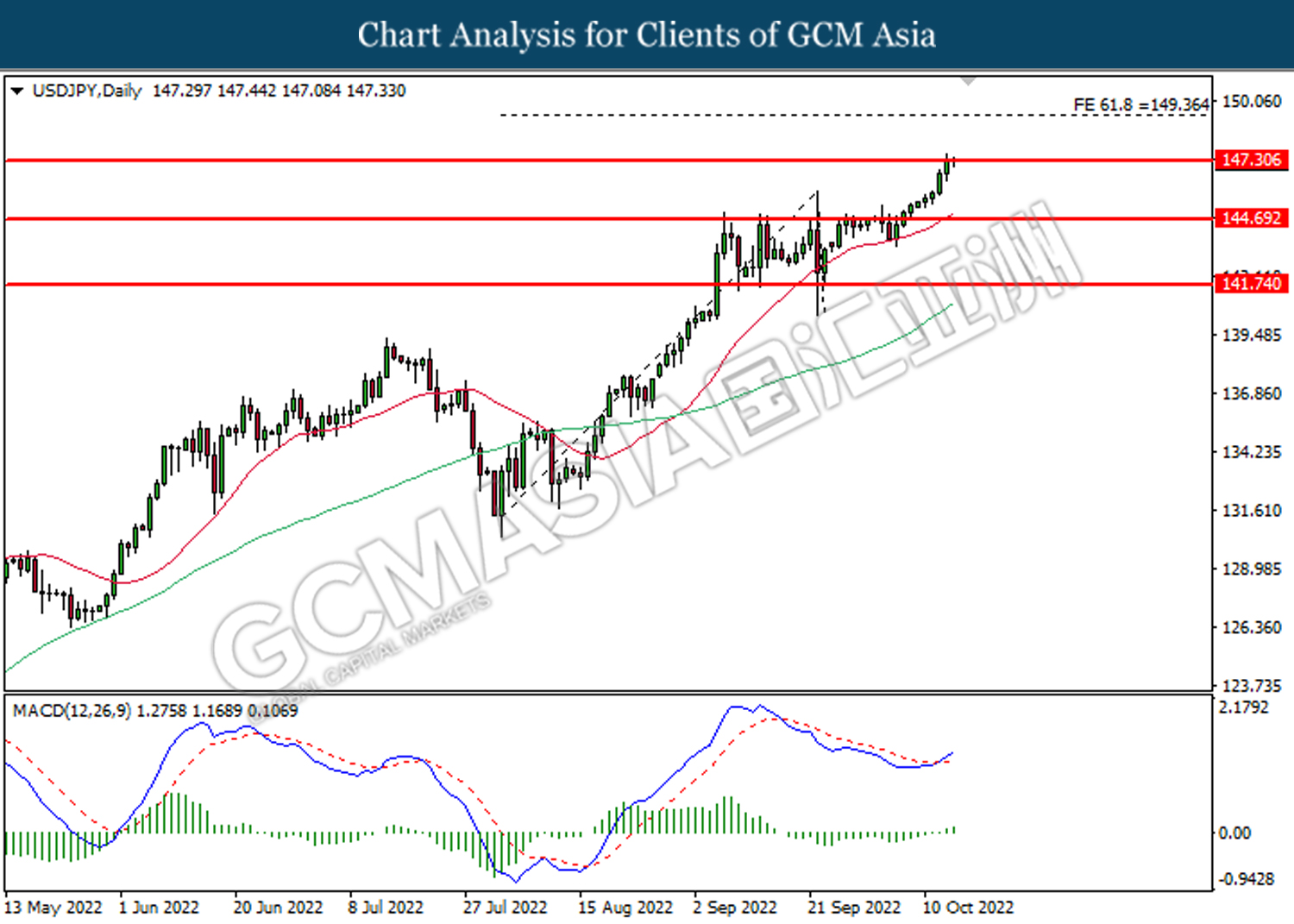

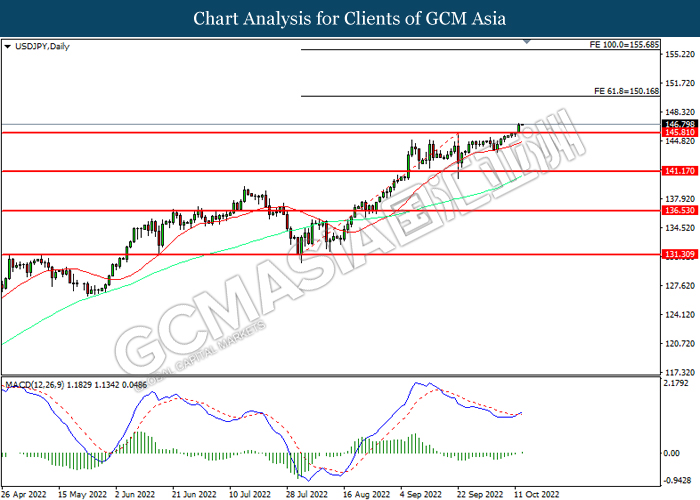

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

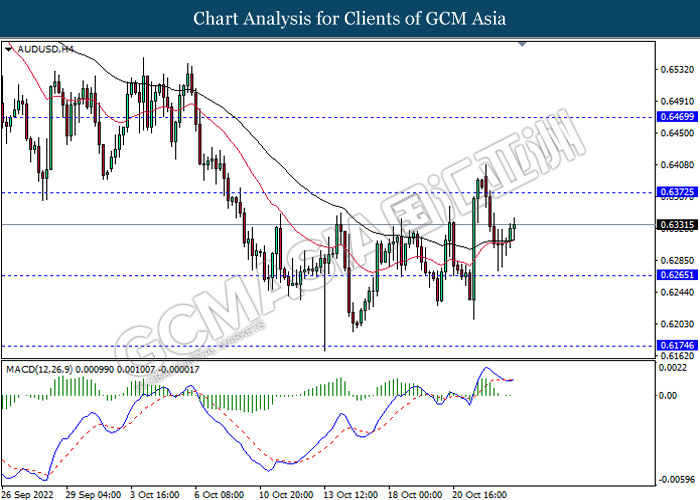

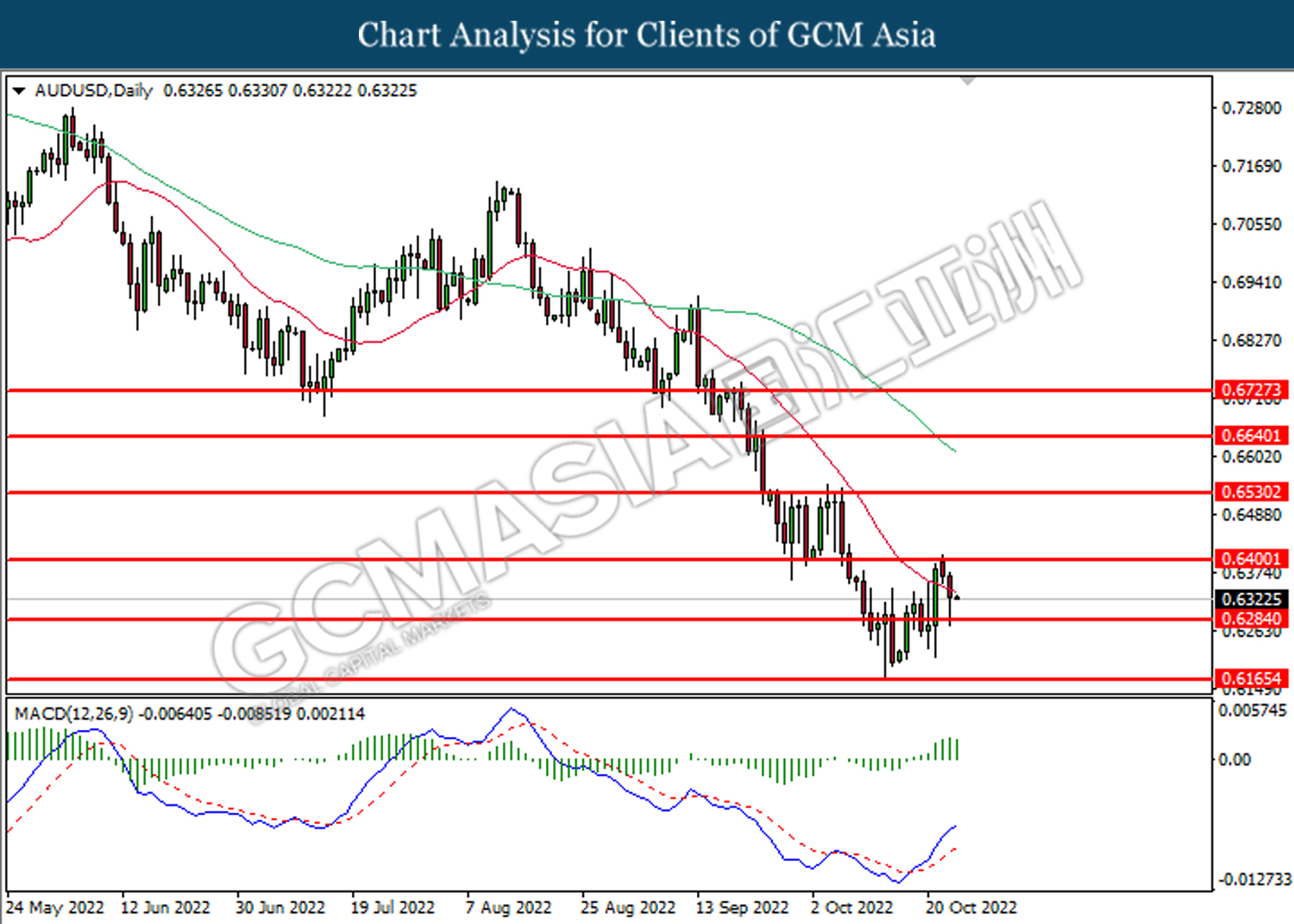

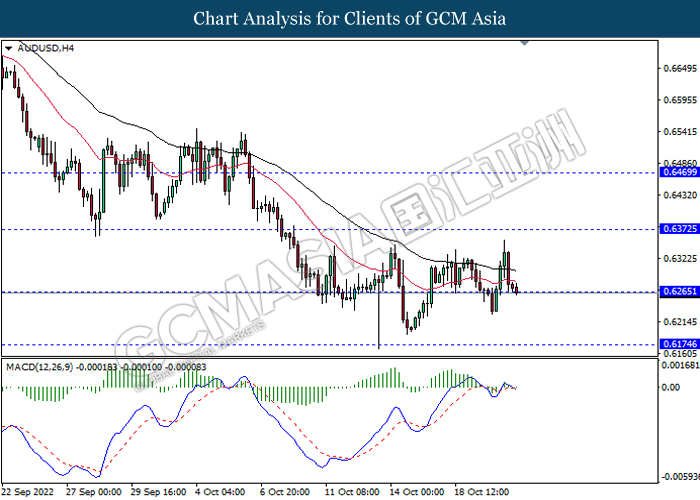

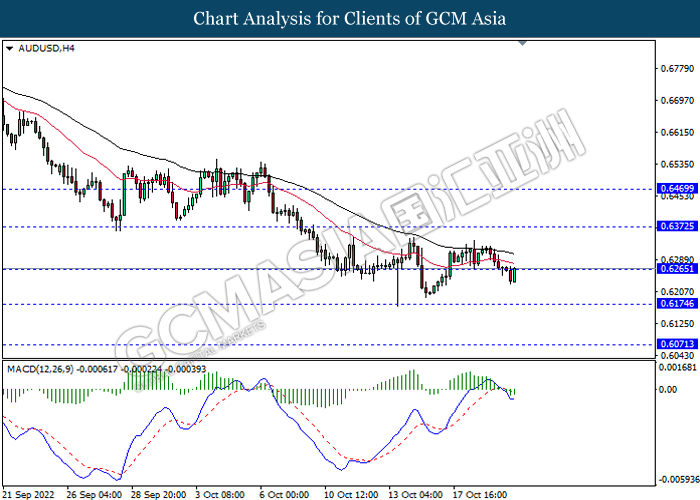

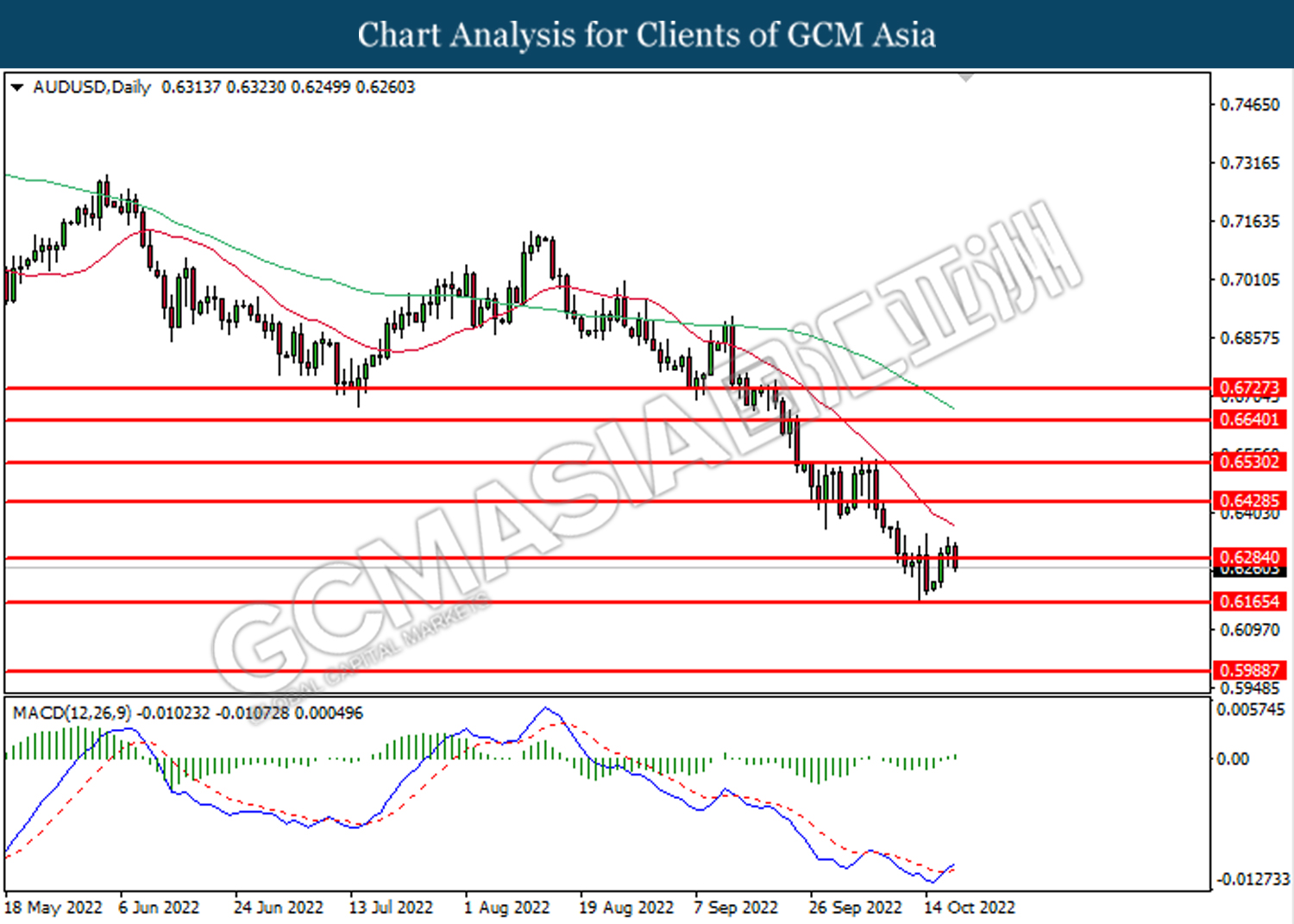

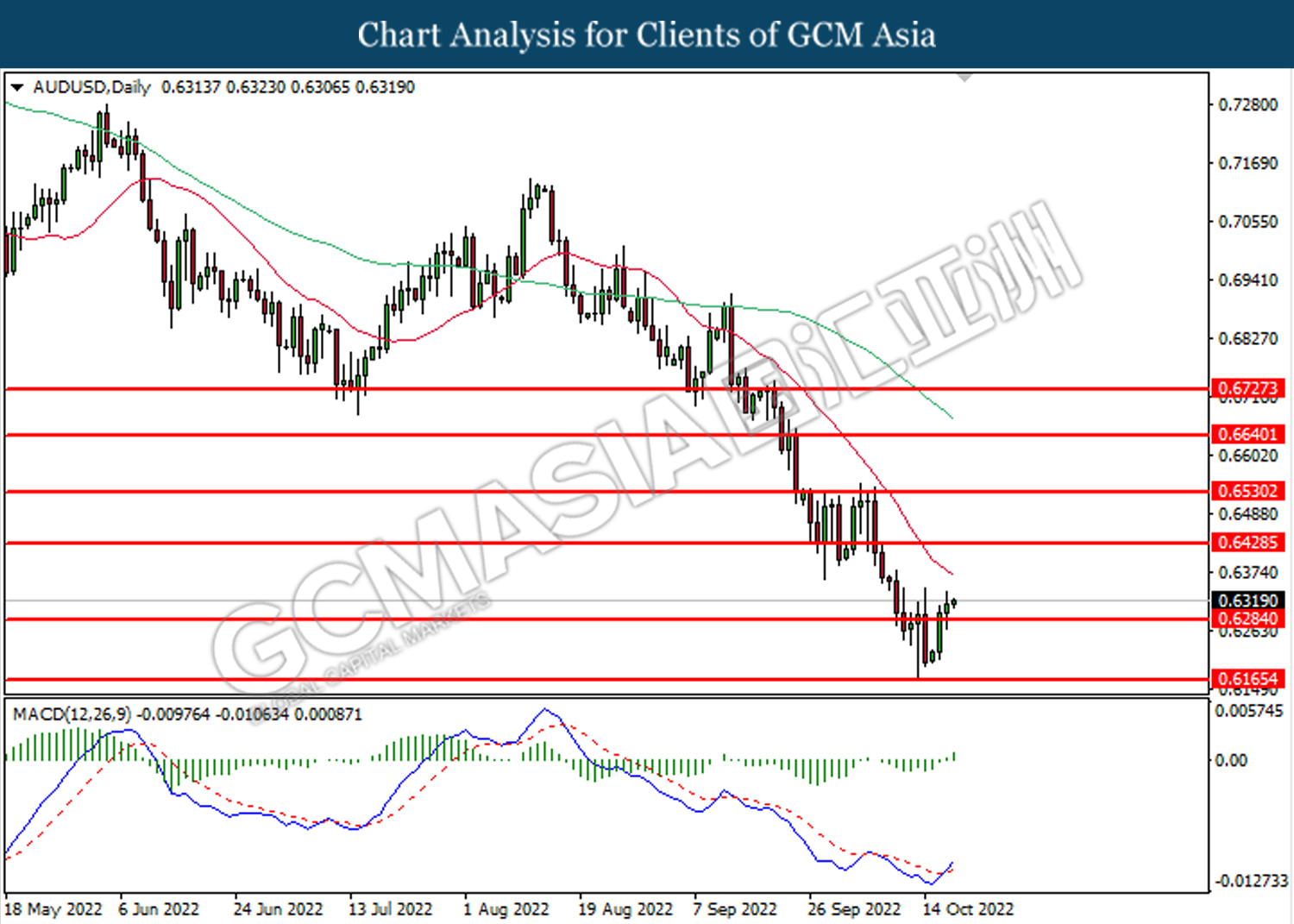

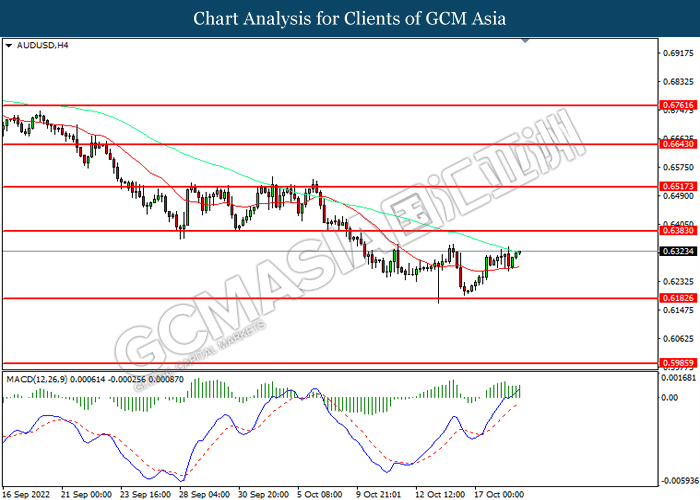

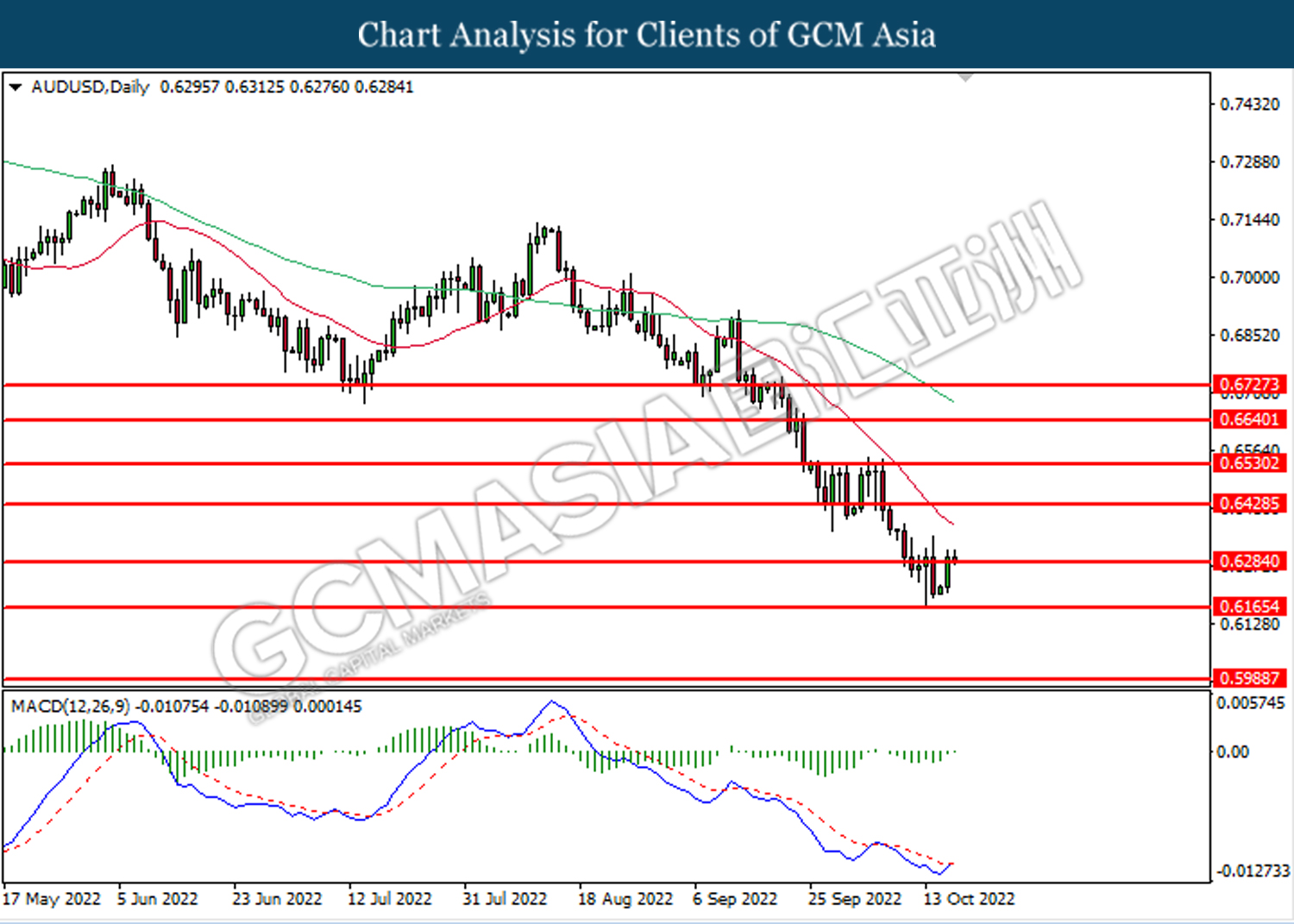

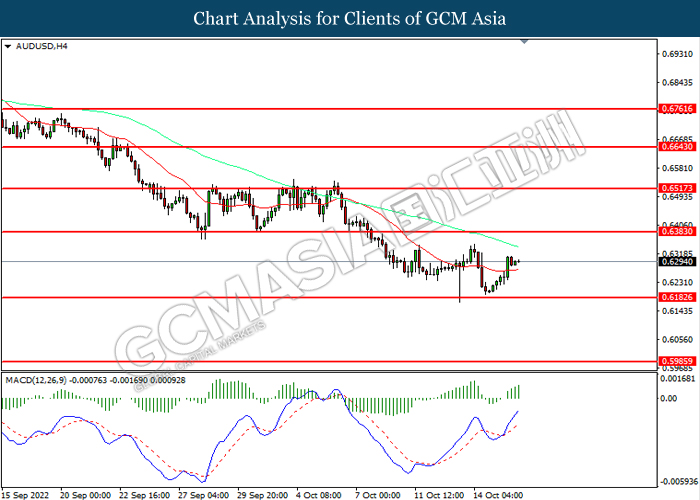

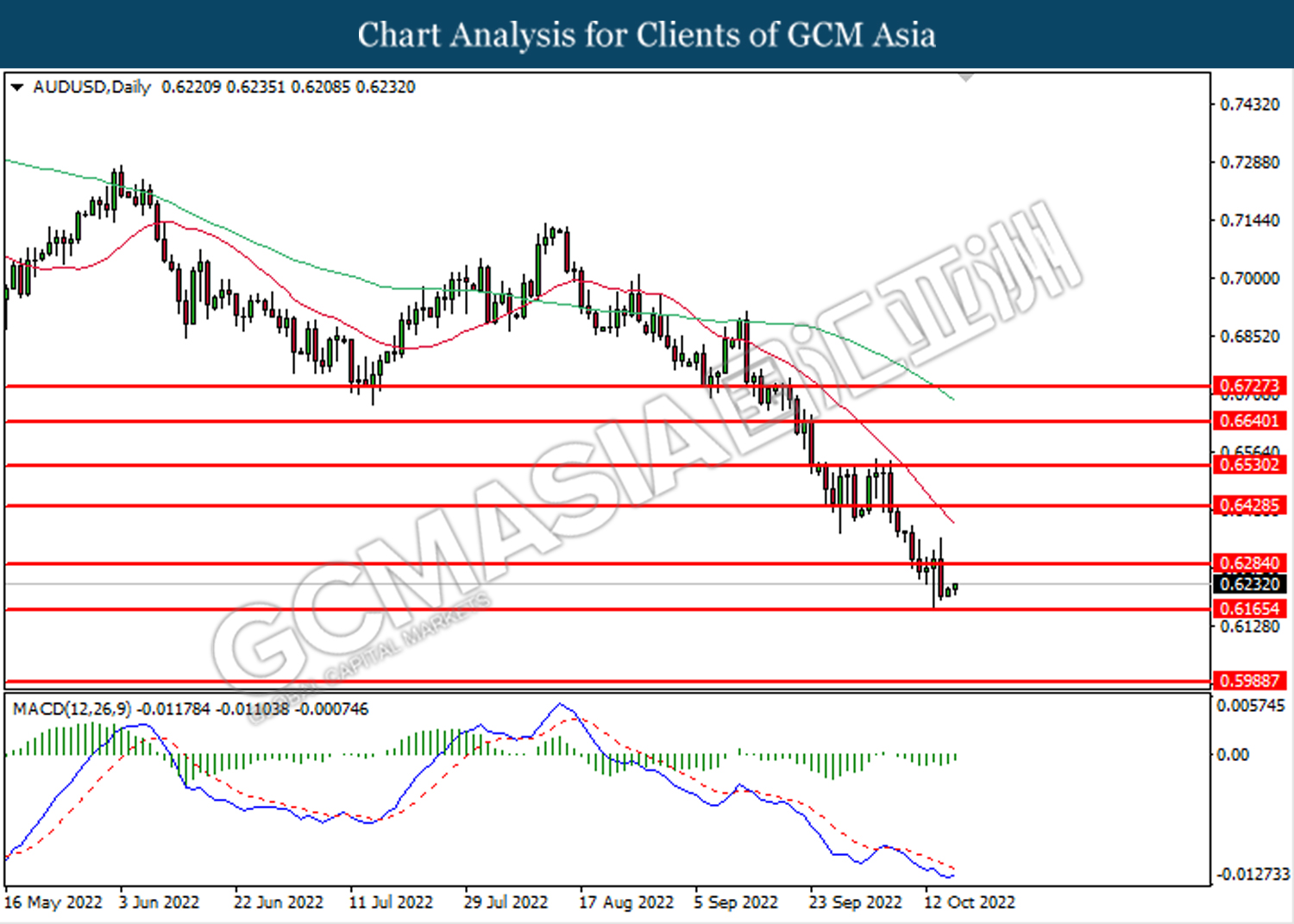

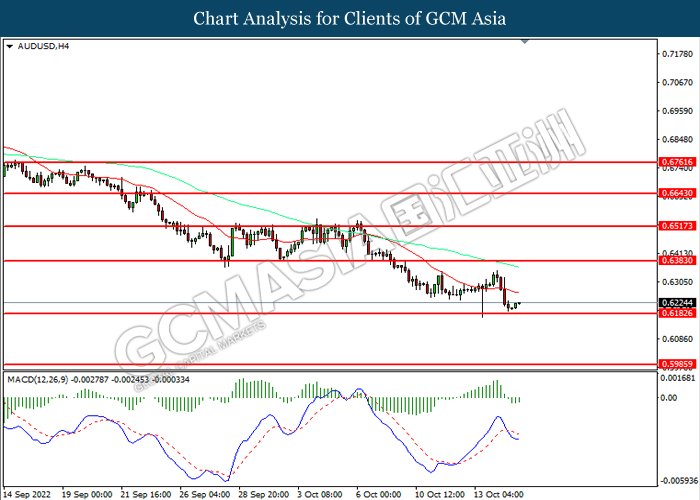

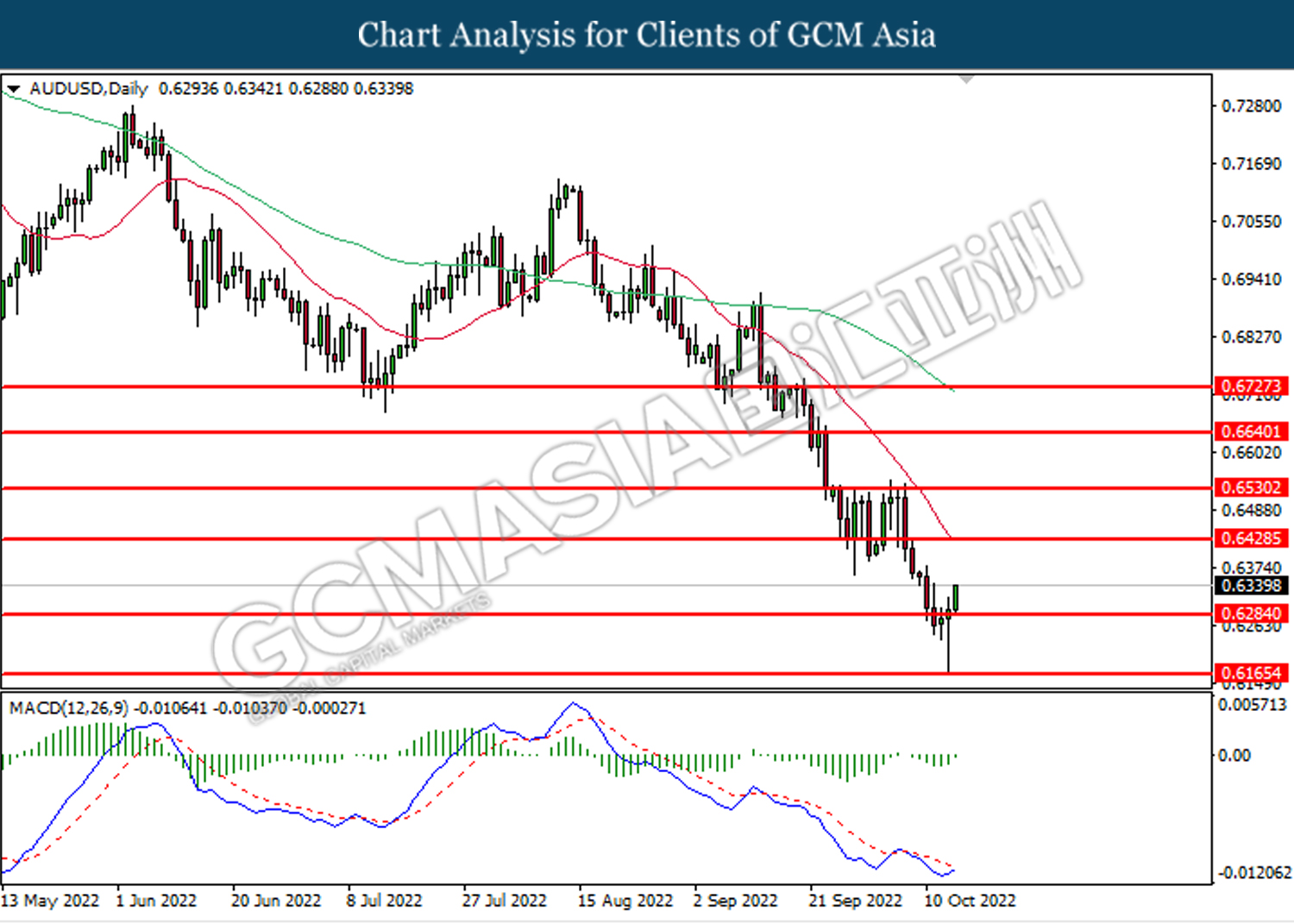

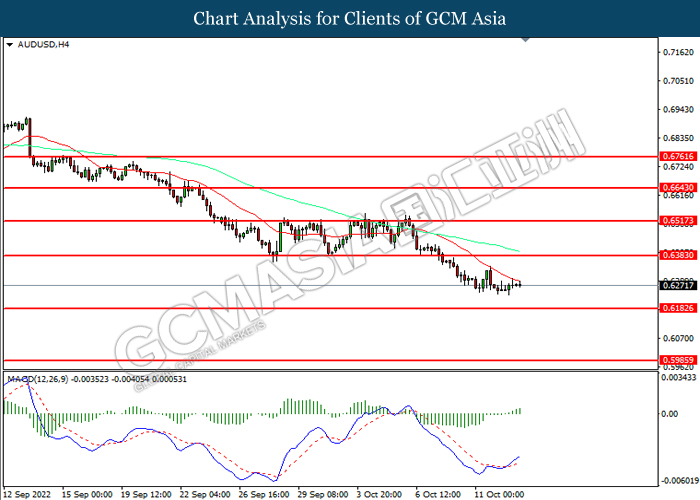

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6175

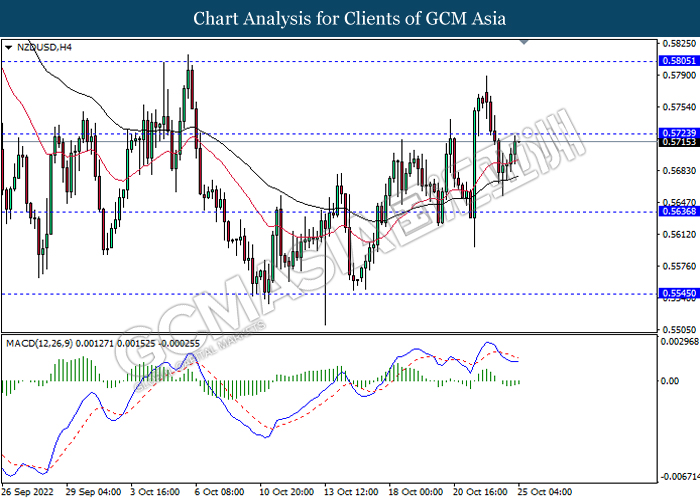

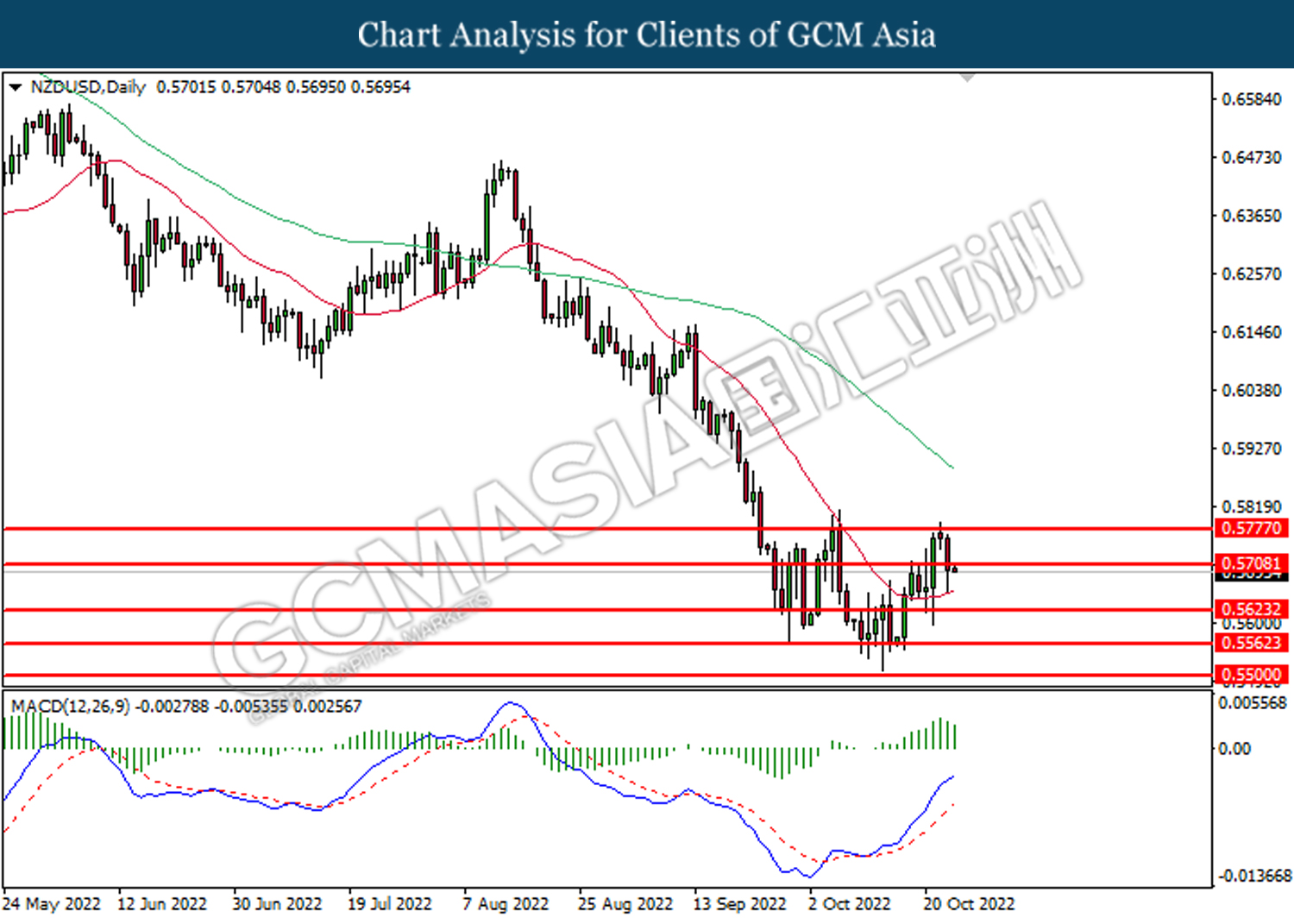

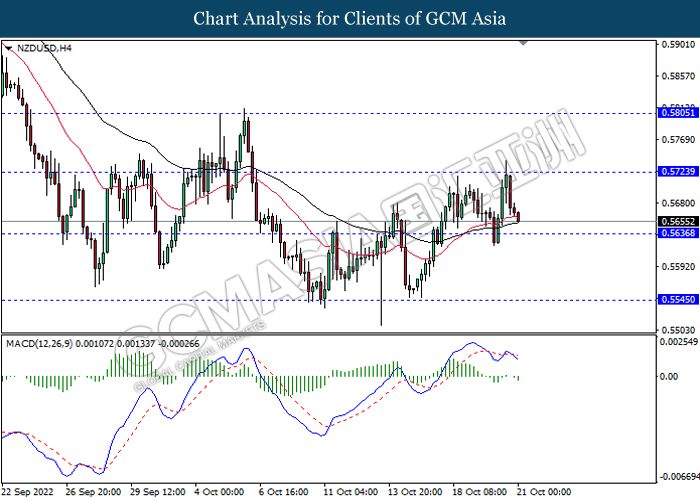

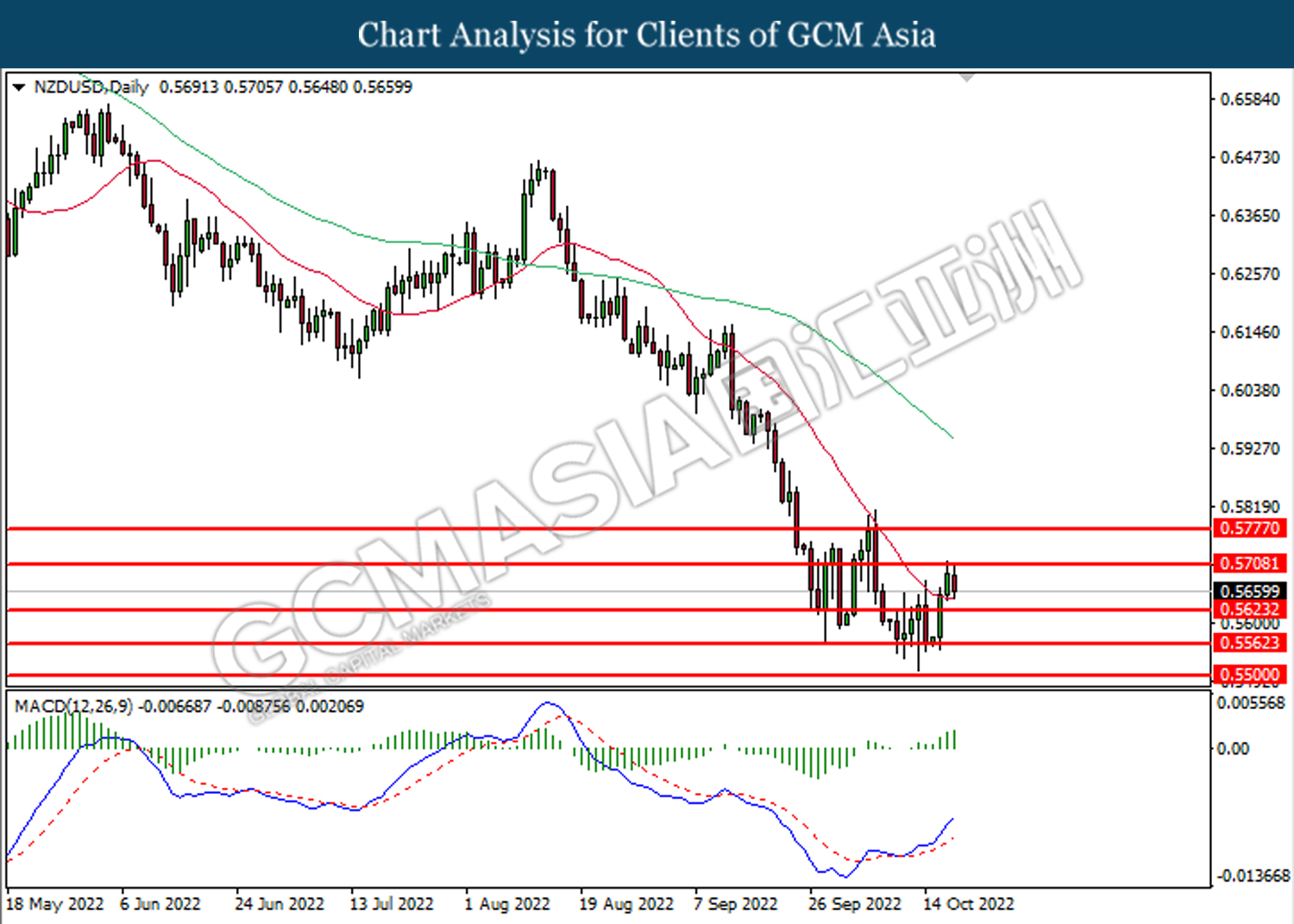

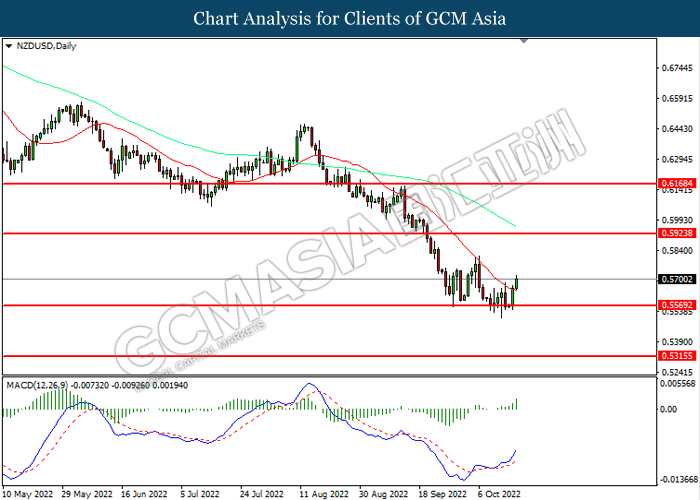

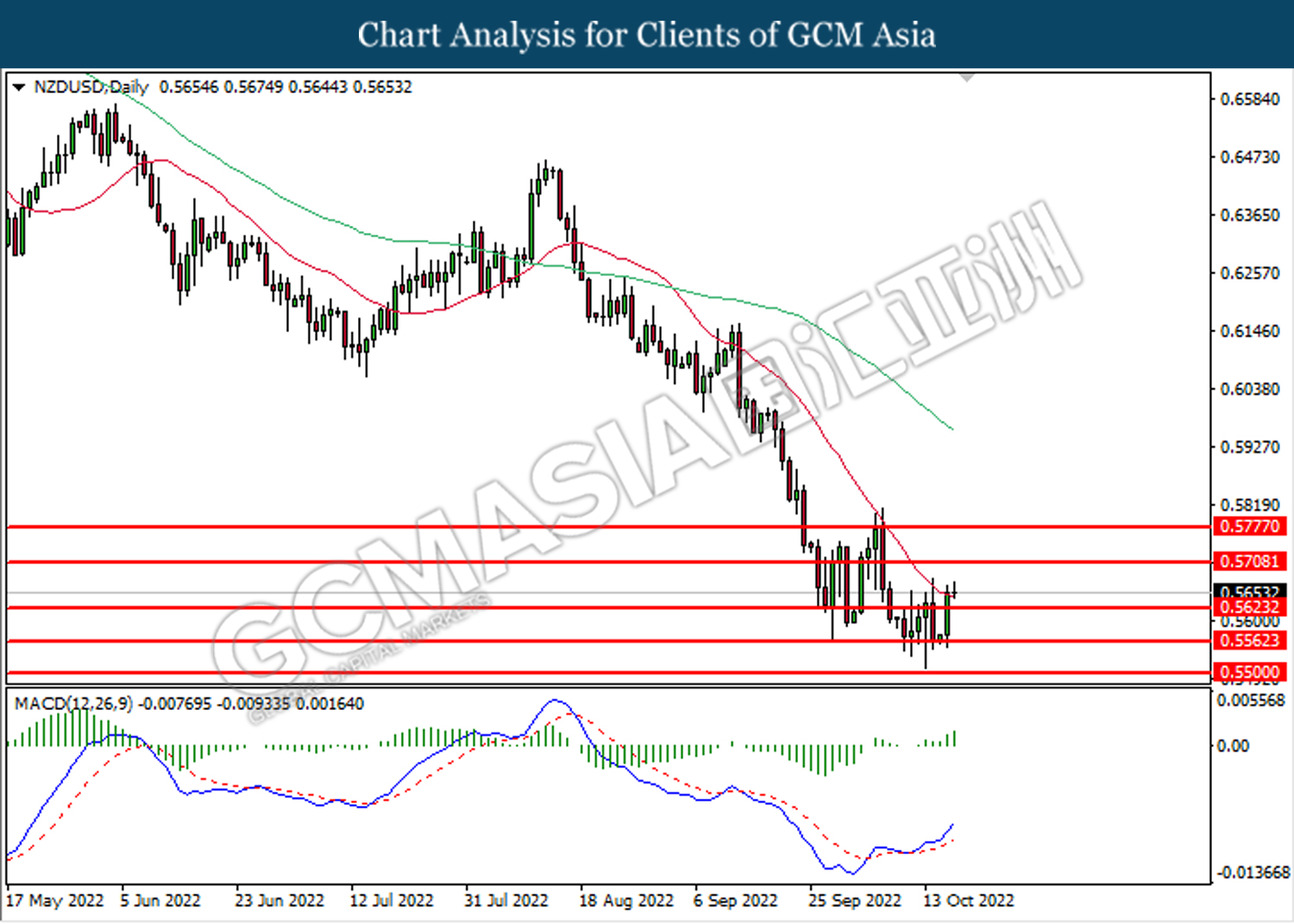

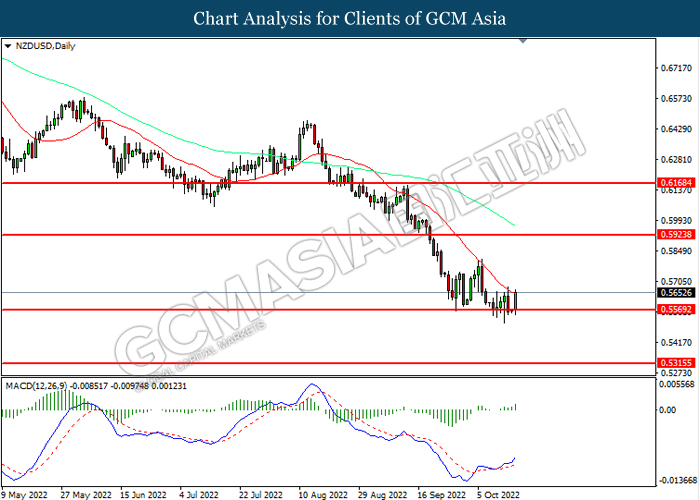

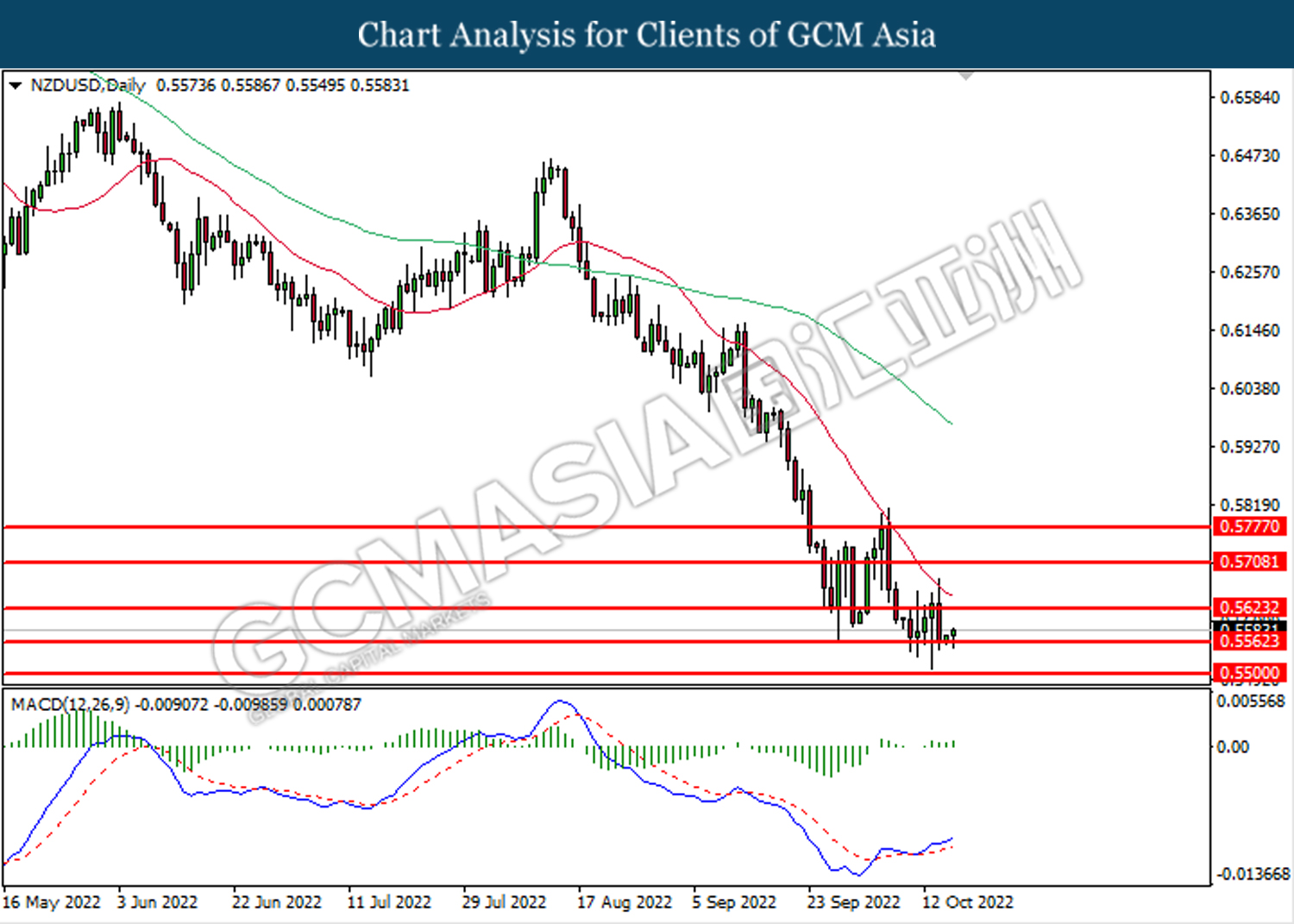

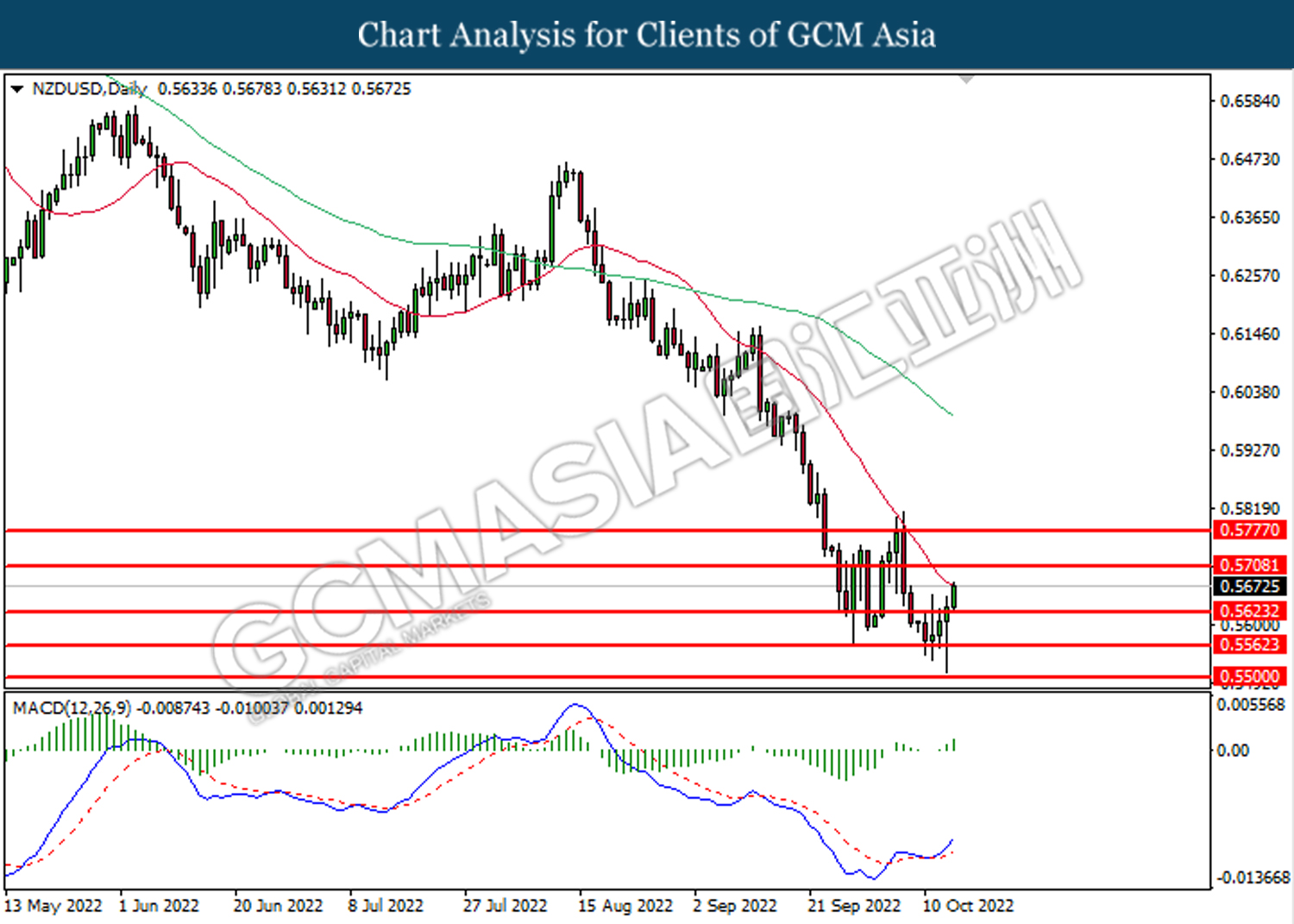

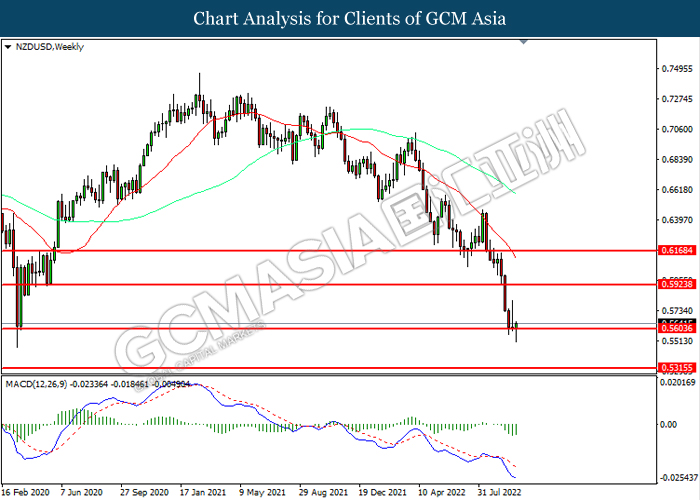

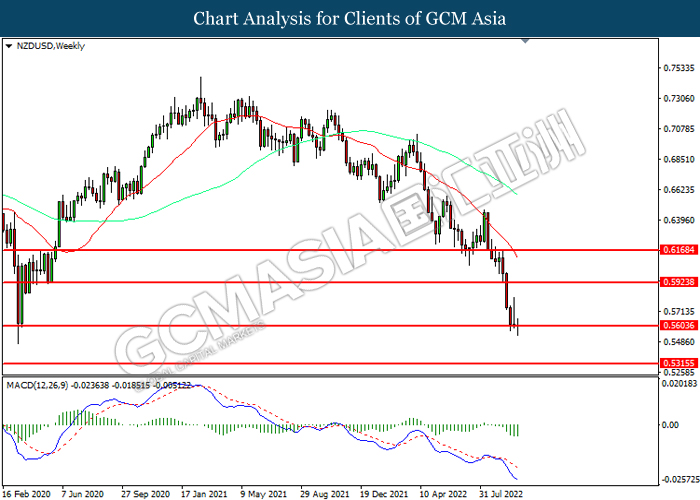

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.5725, 0.5805

Support level: 0.5635, 0.5545

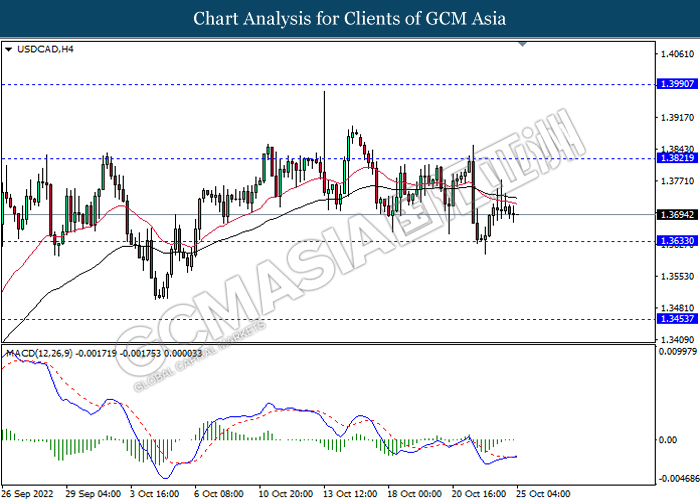

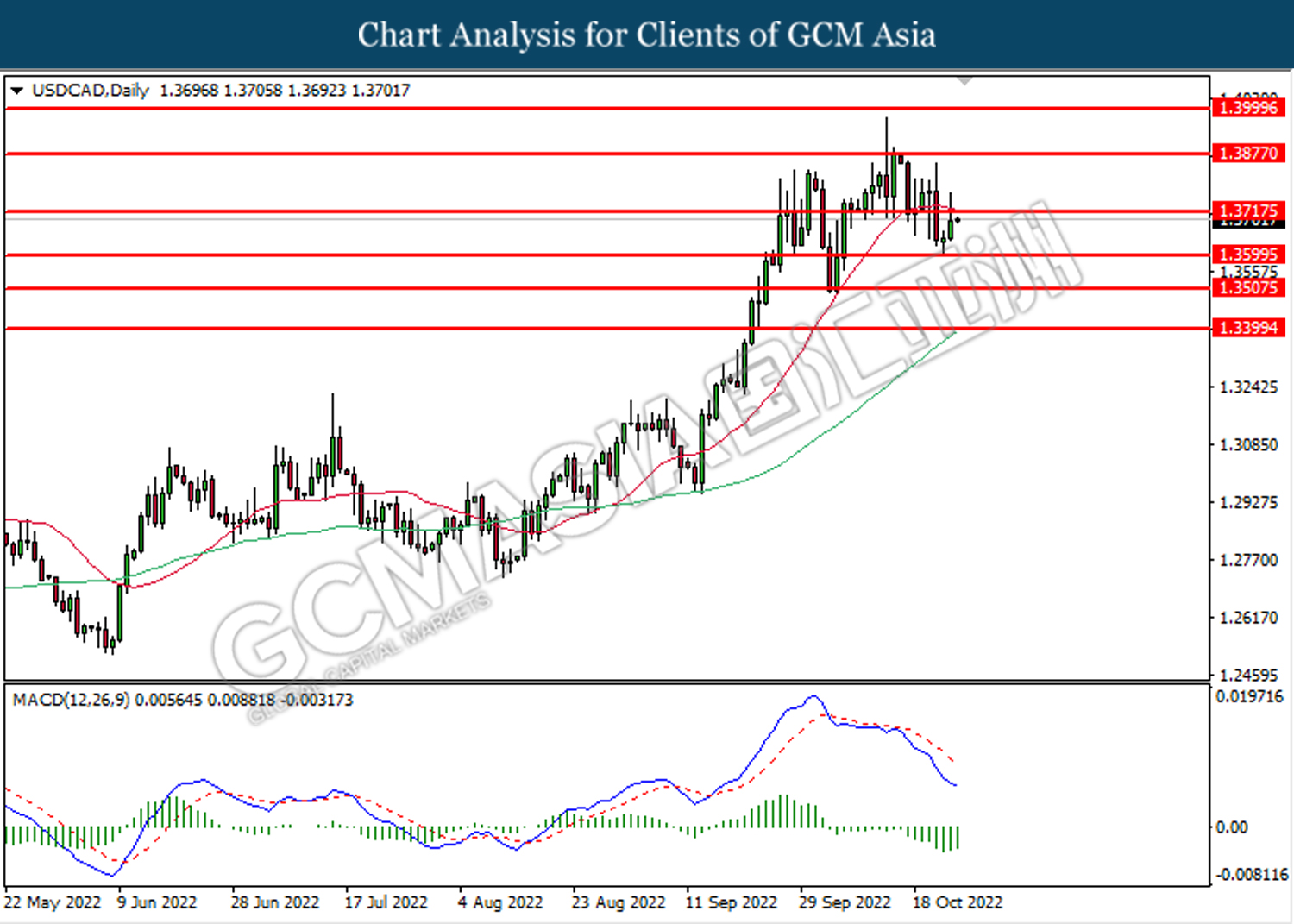

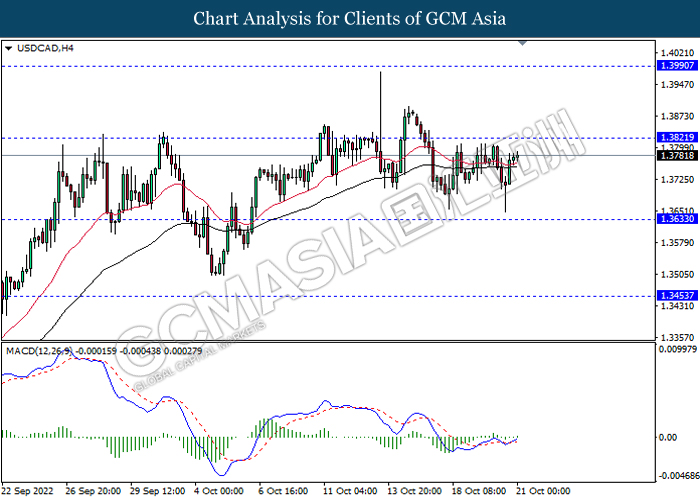

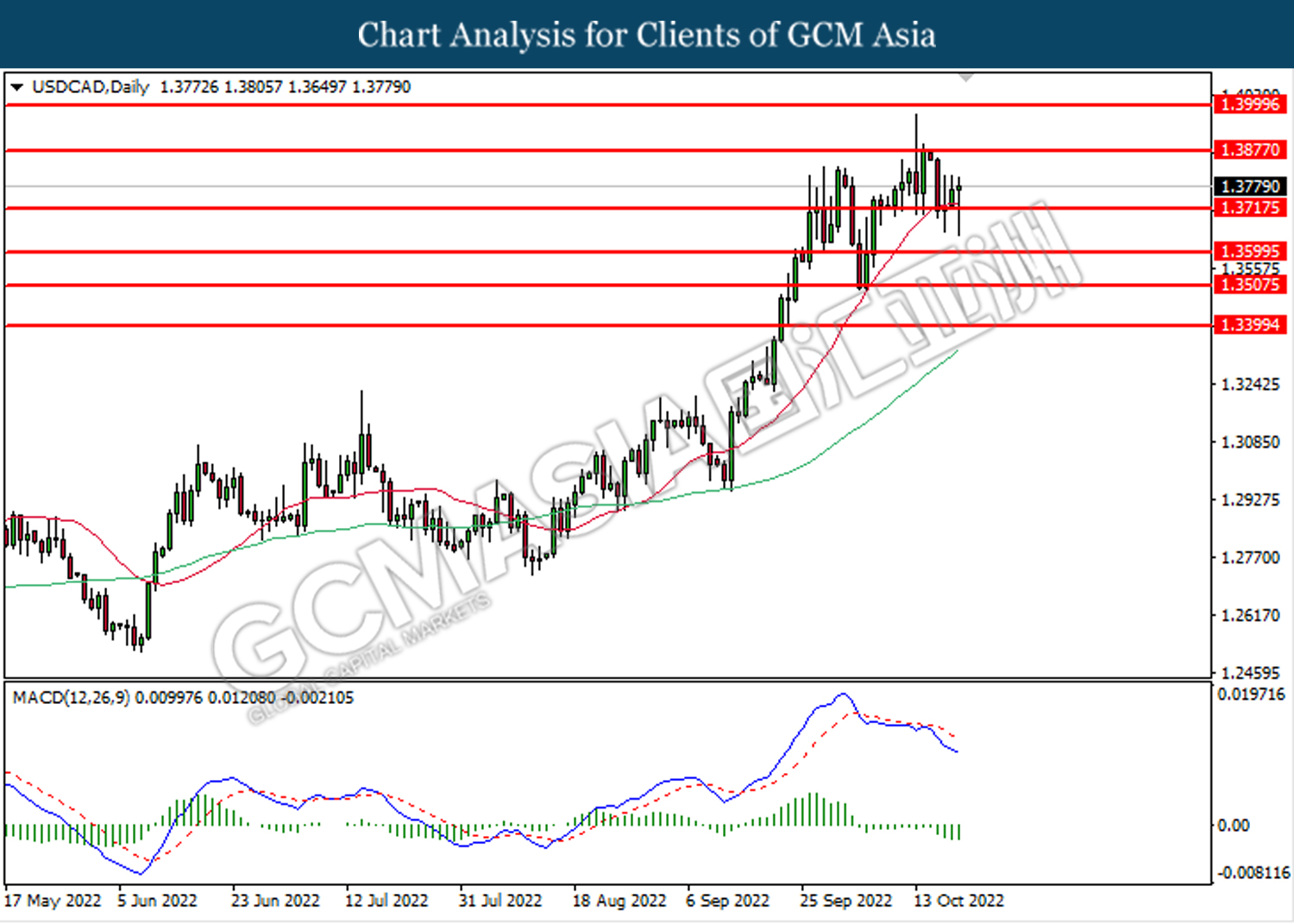

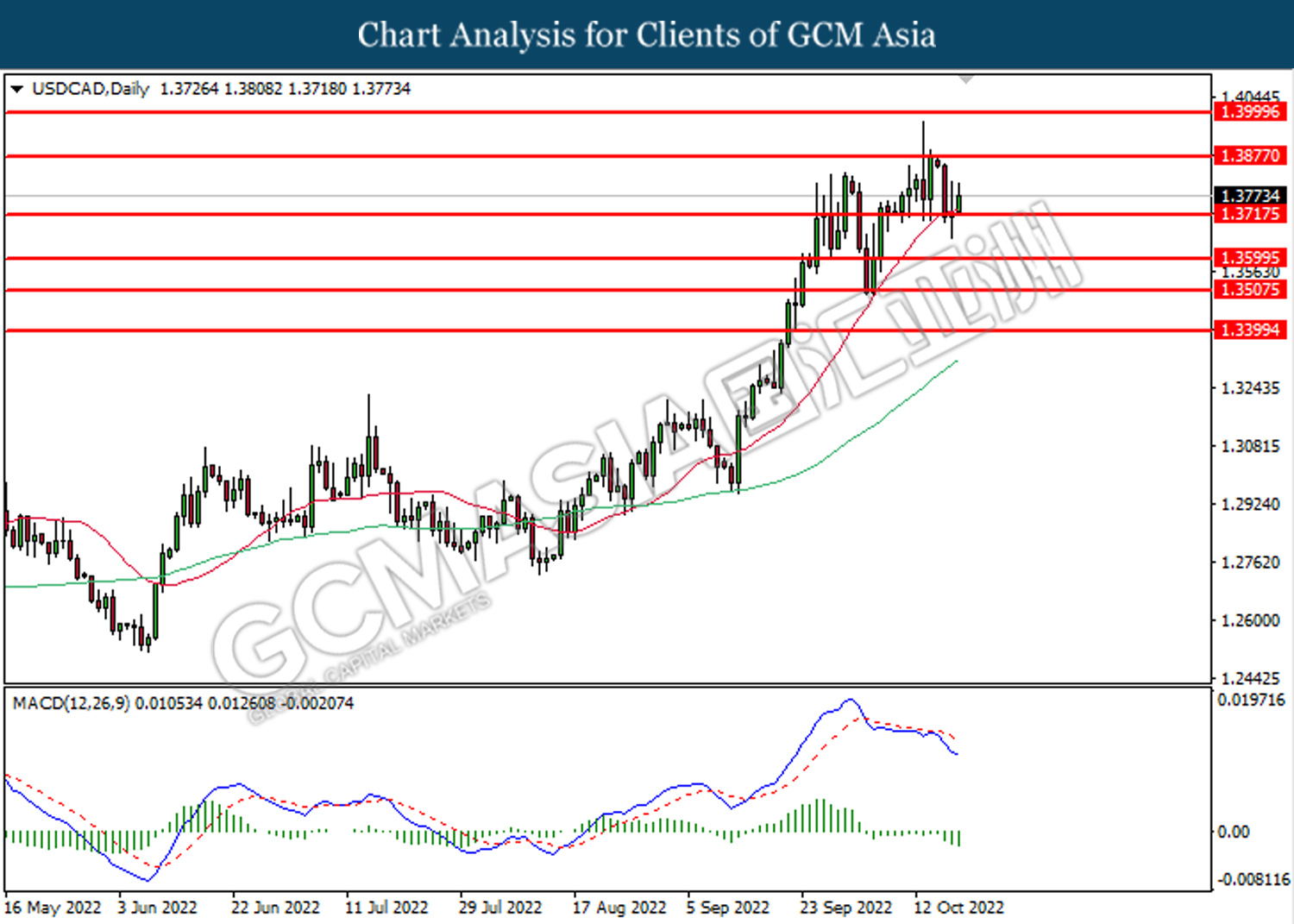

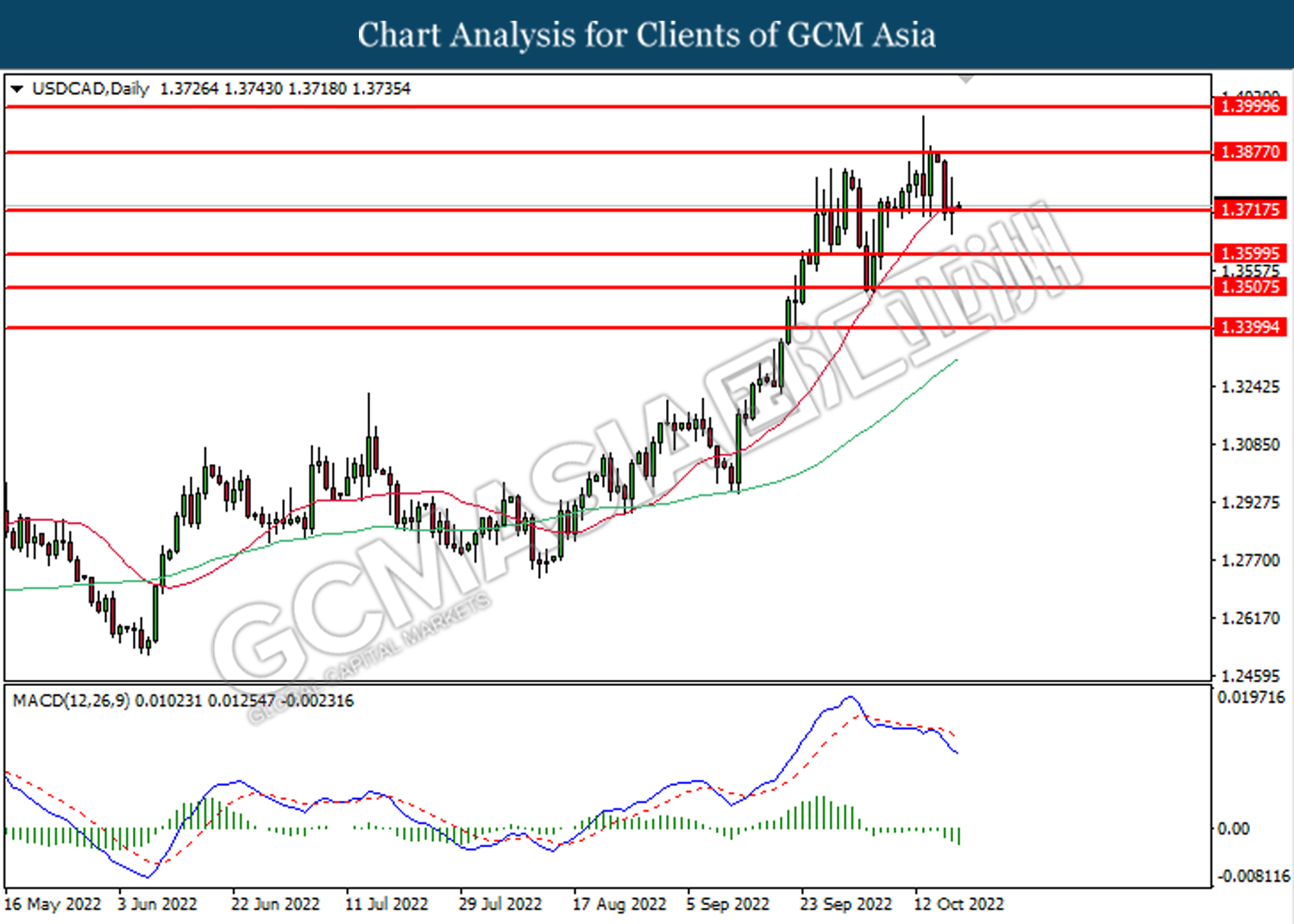

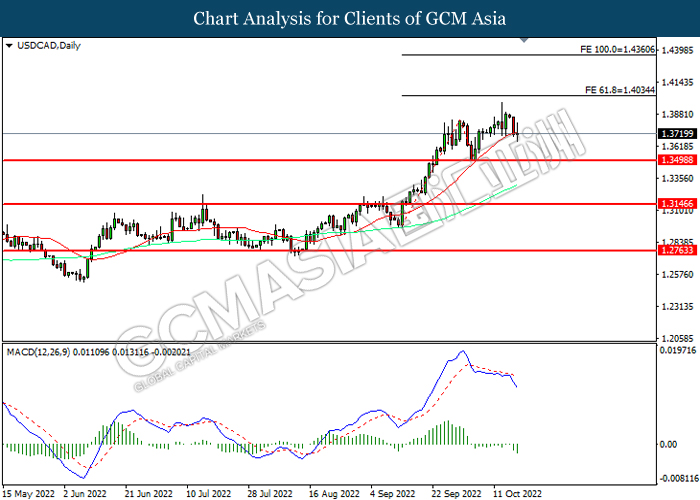

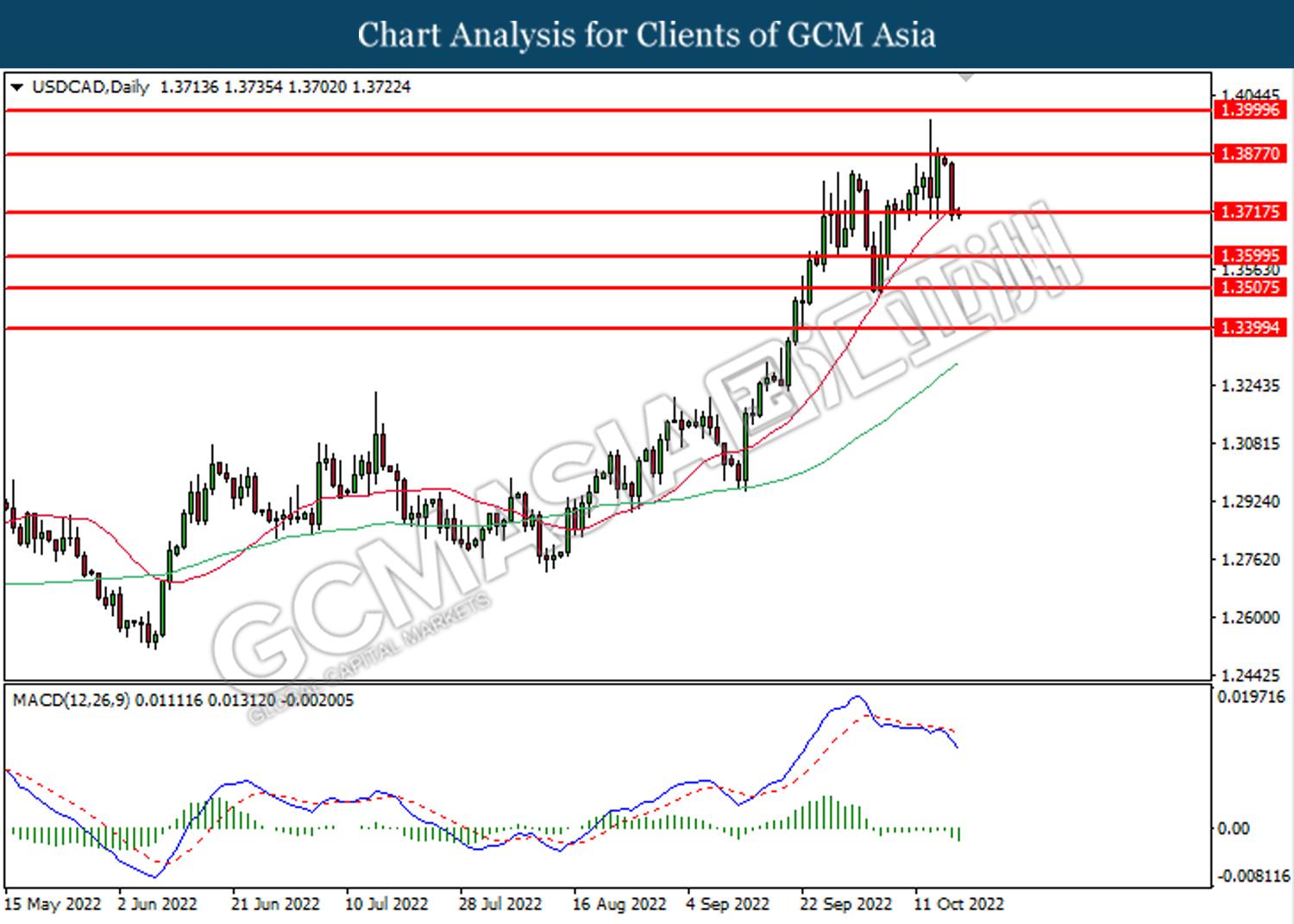

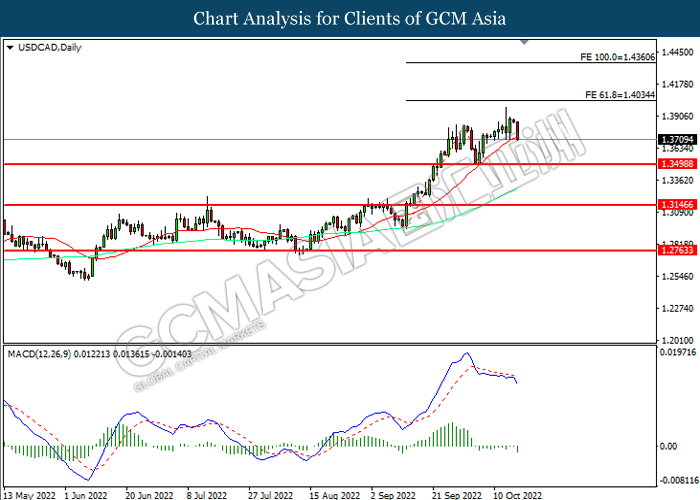

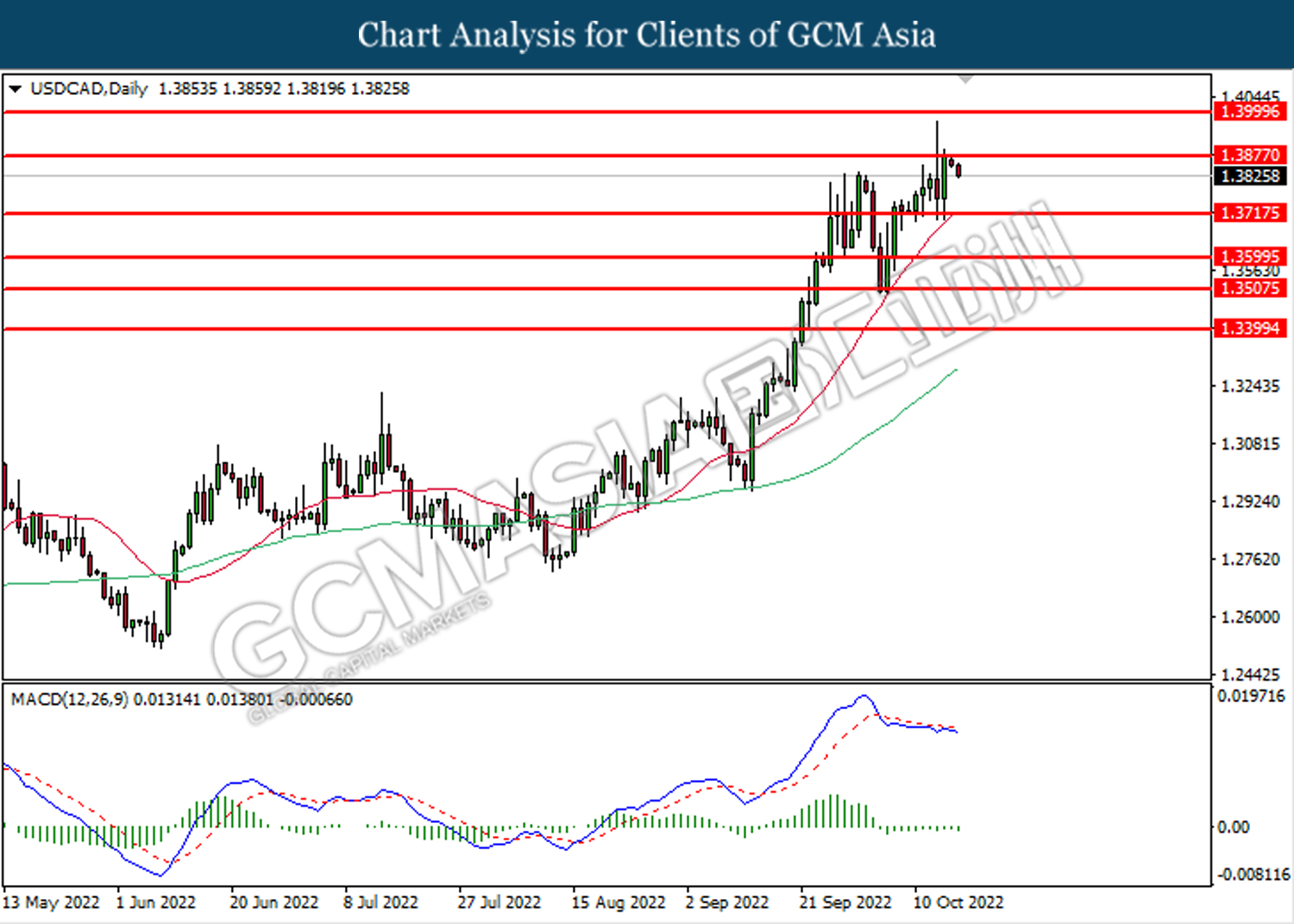

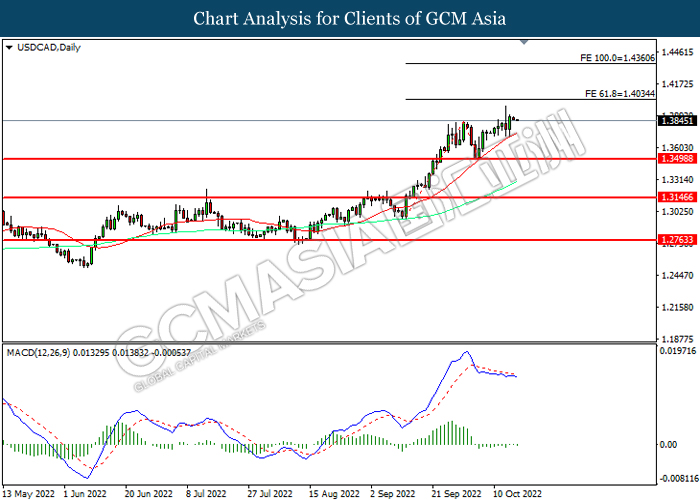

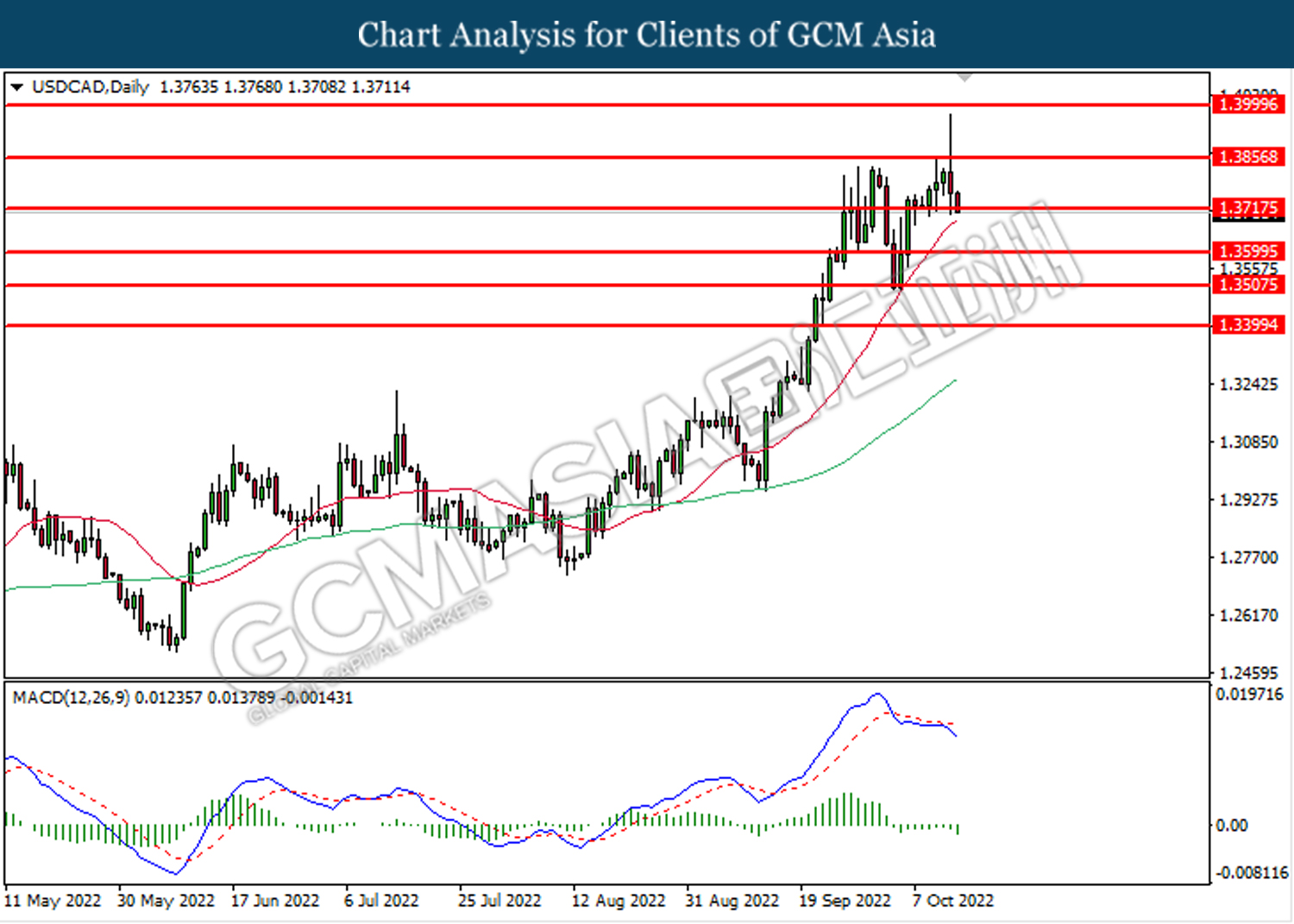

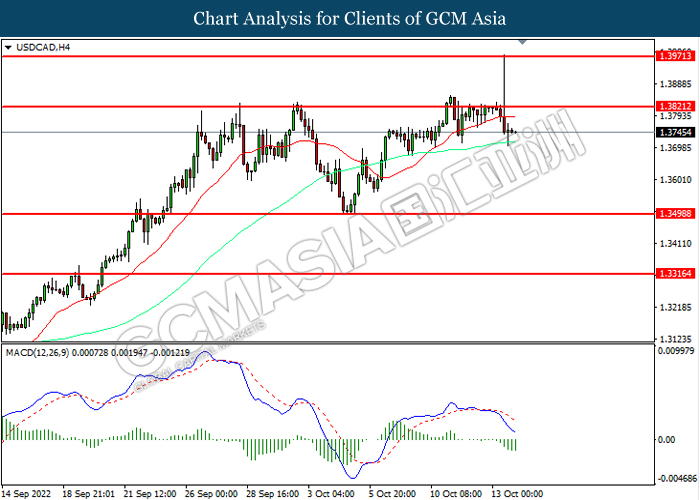

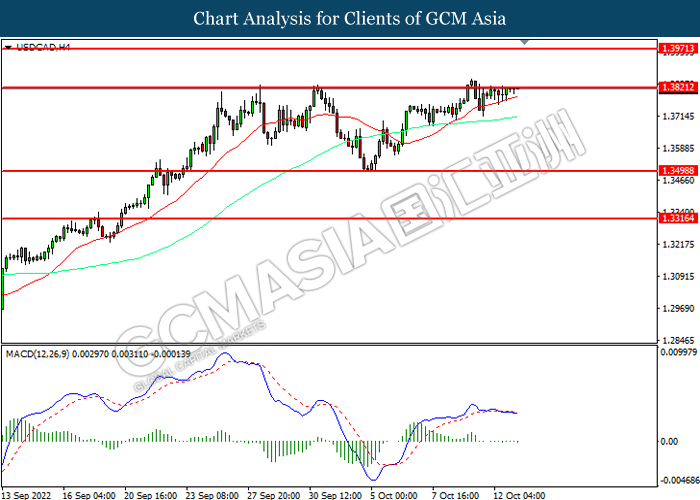

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

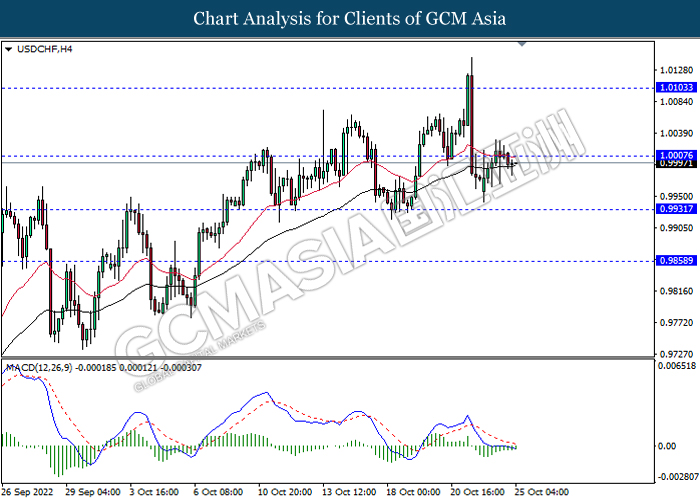

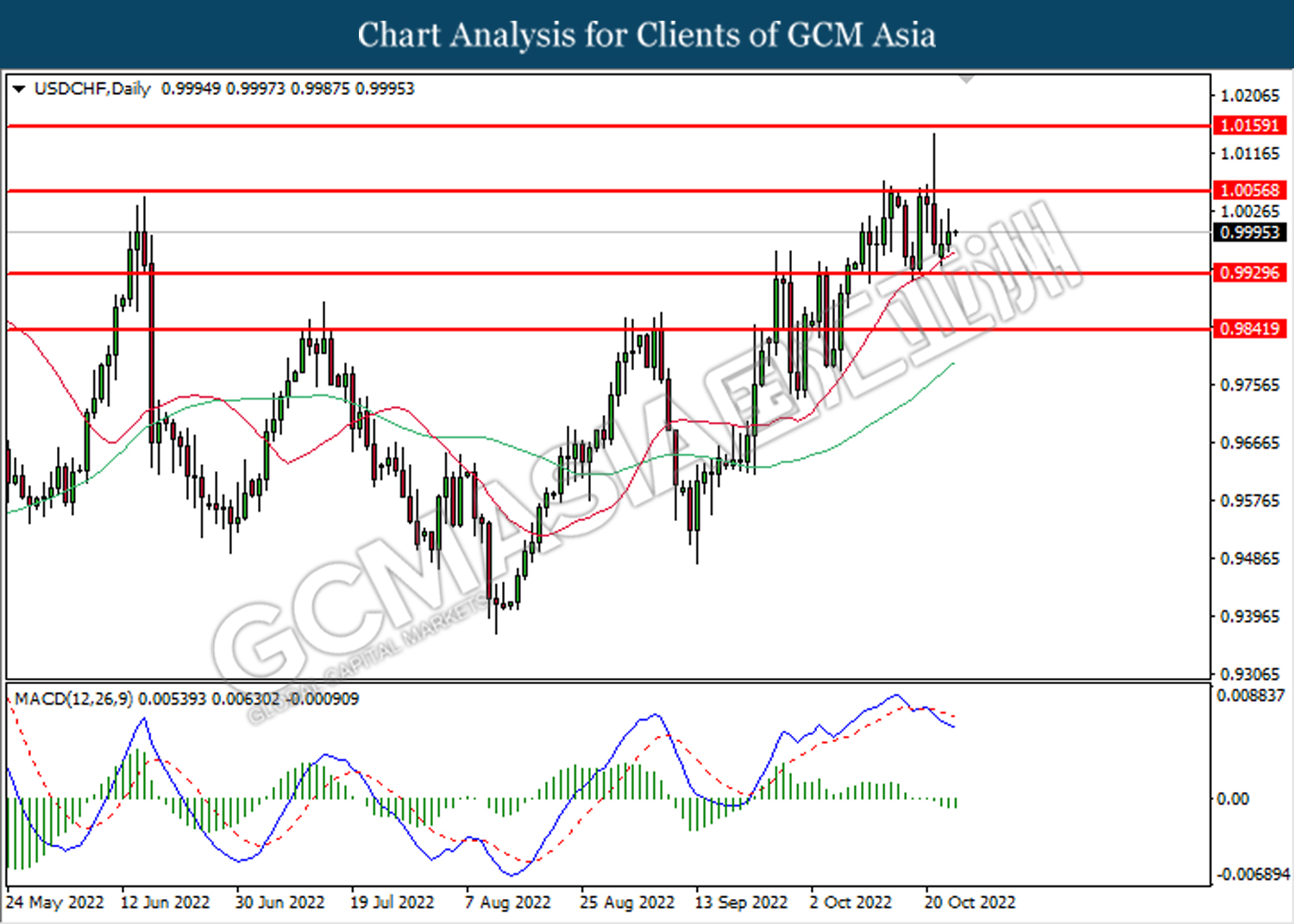

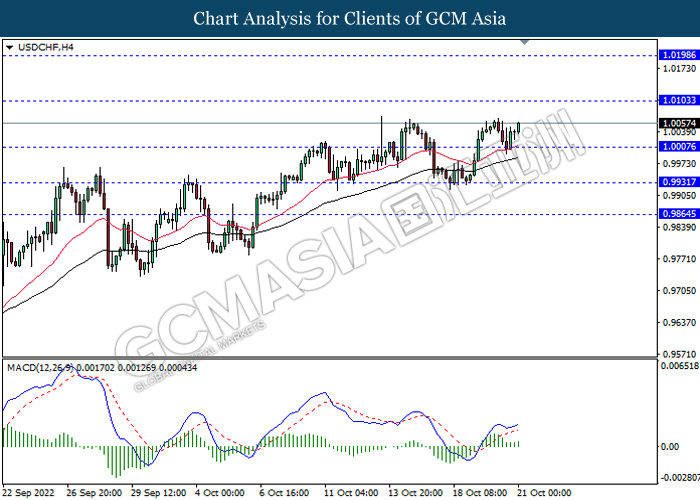

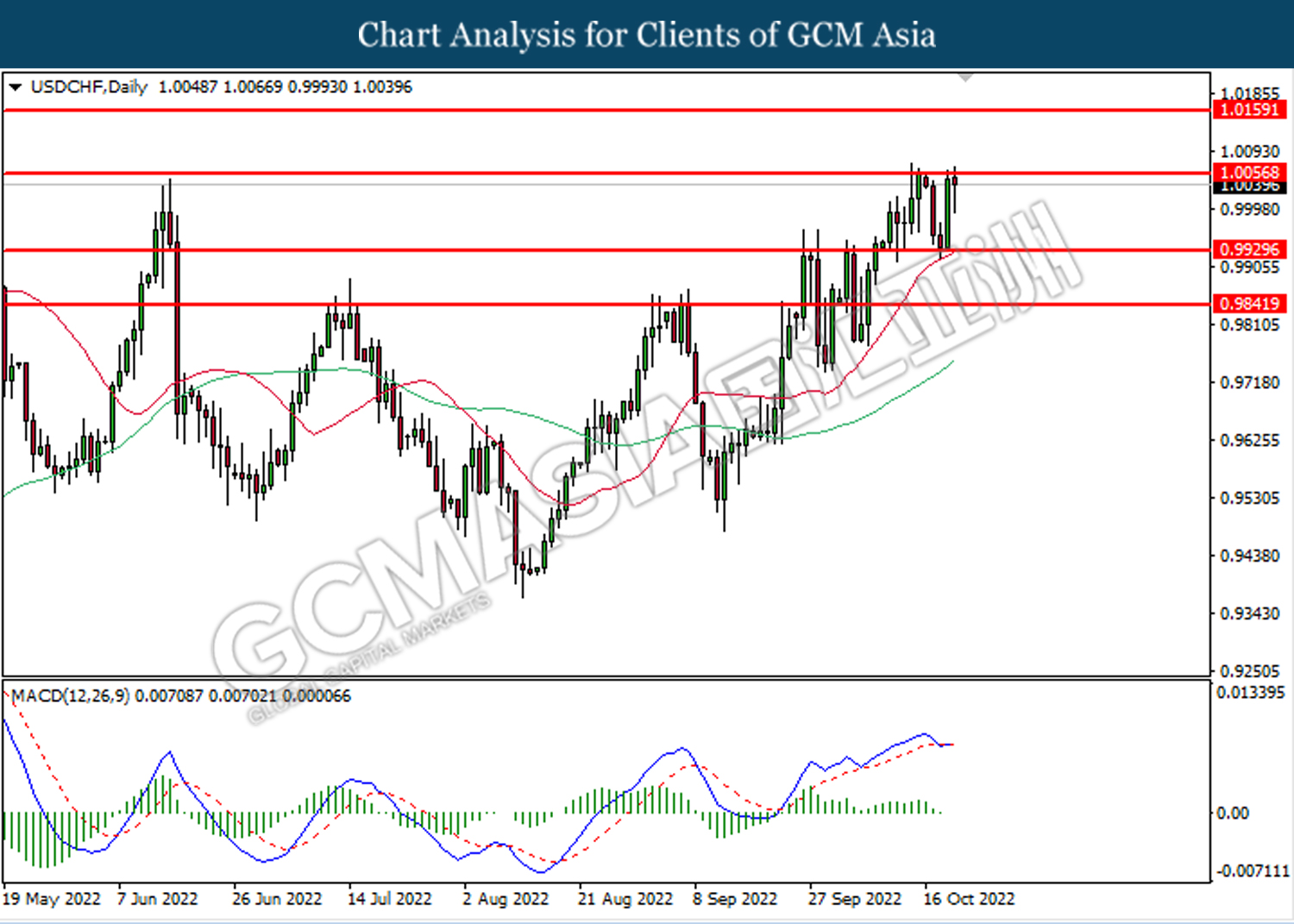

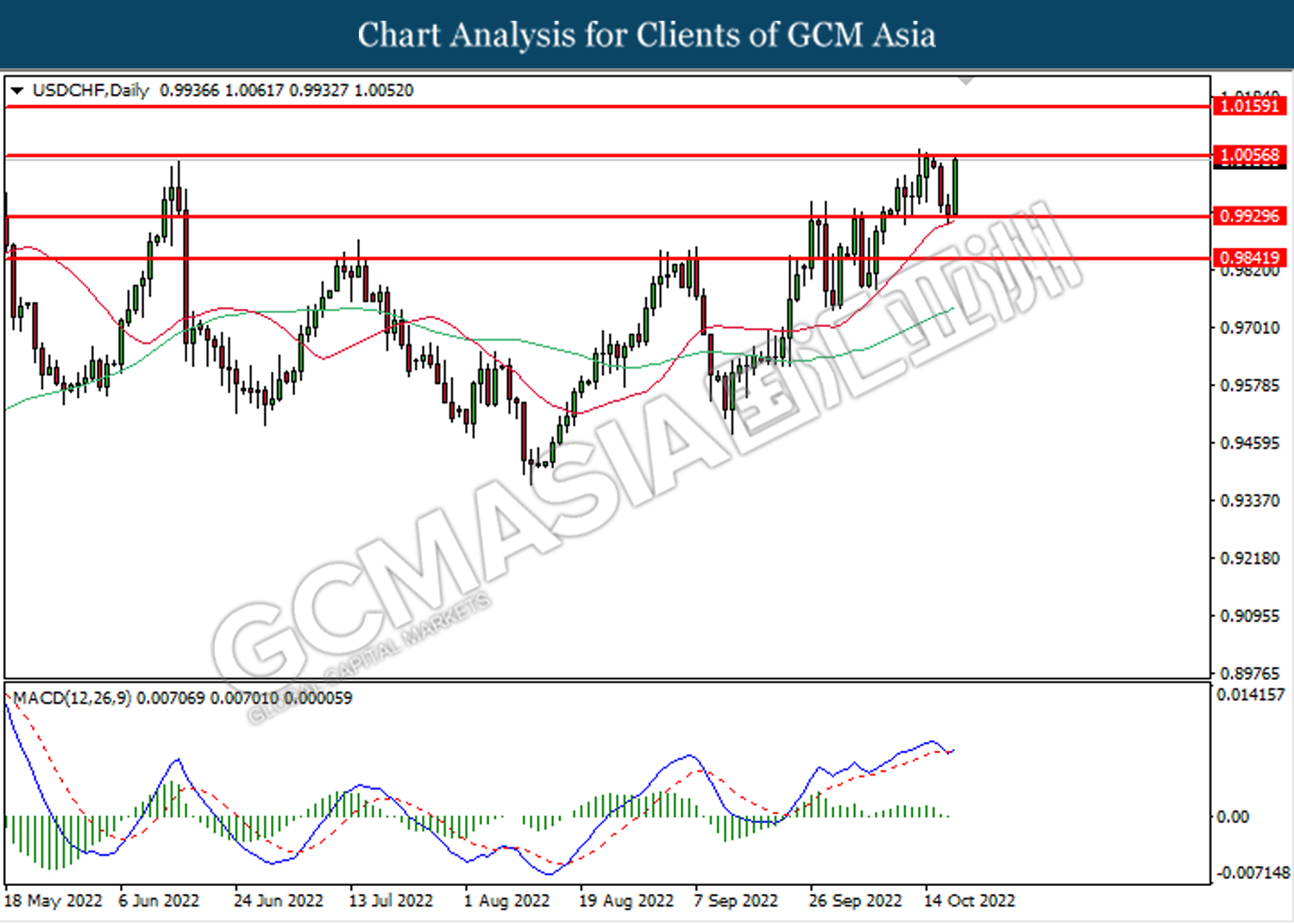

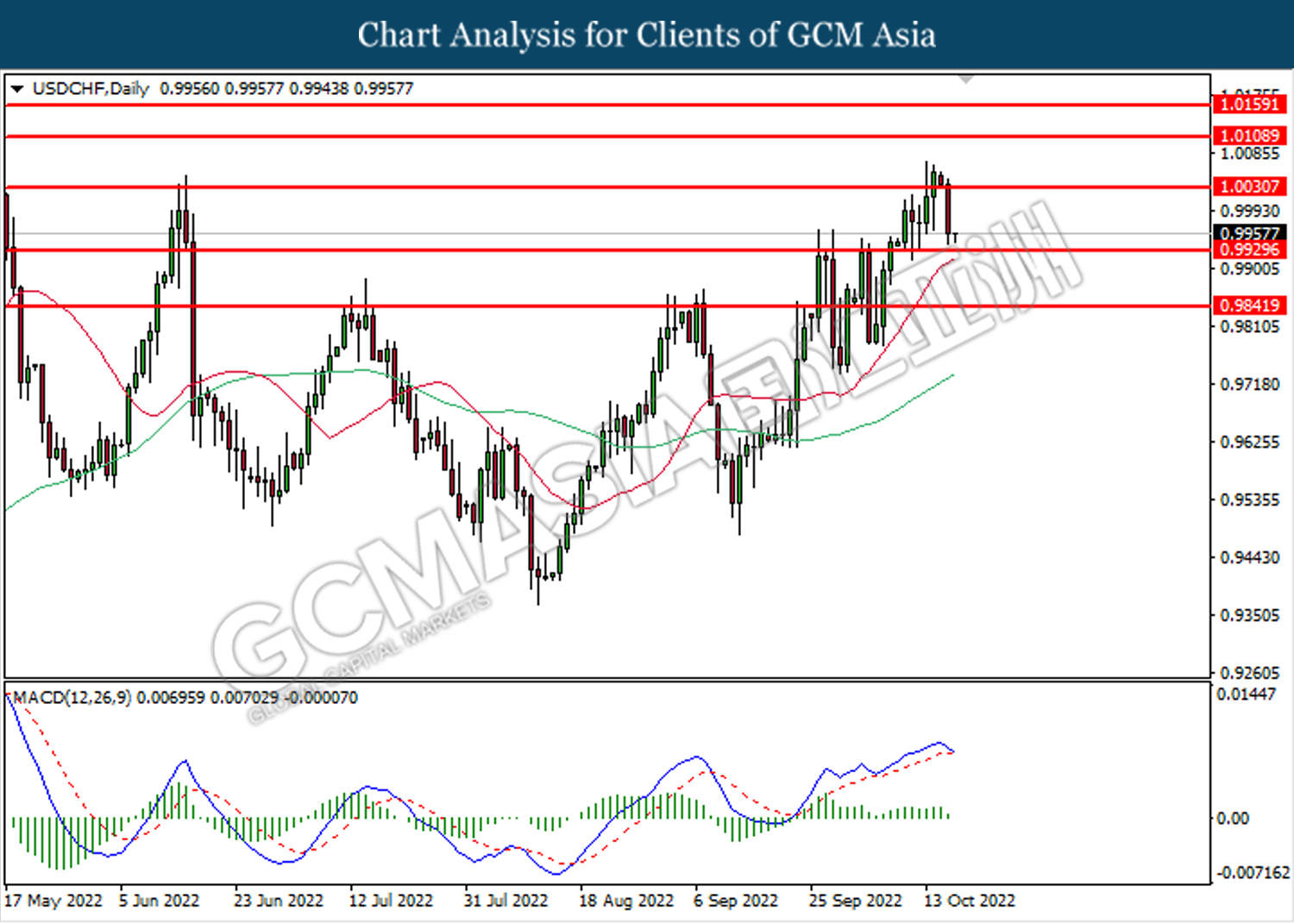

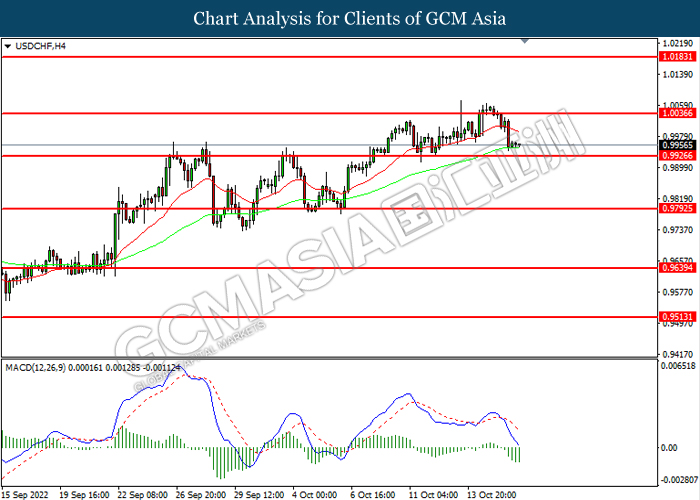

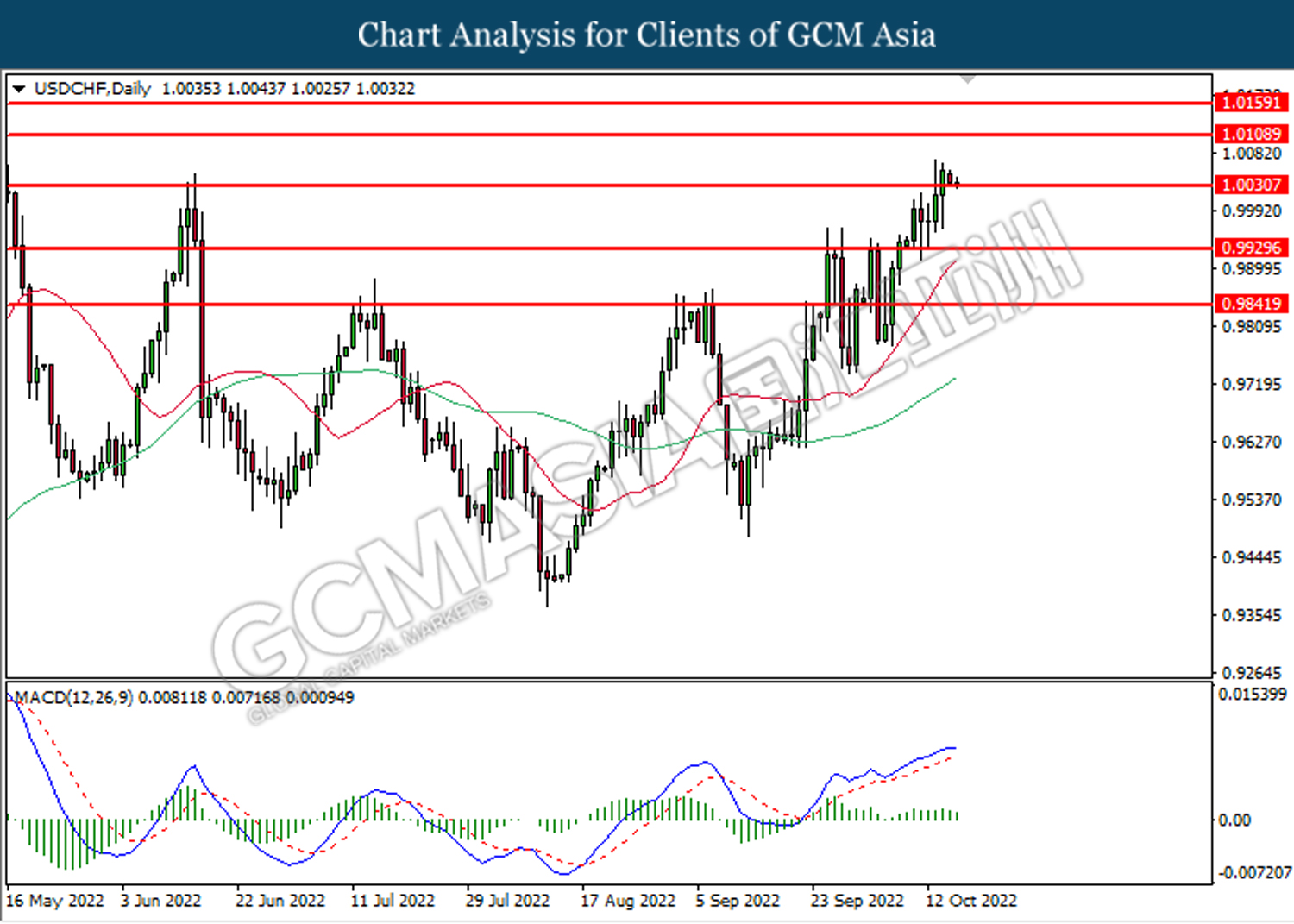

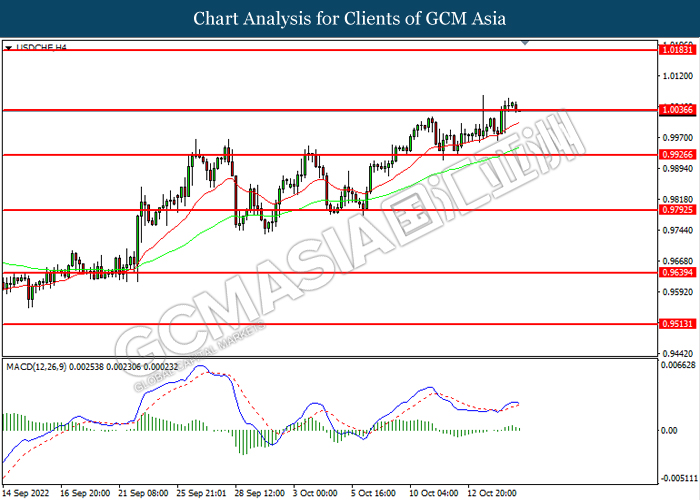

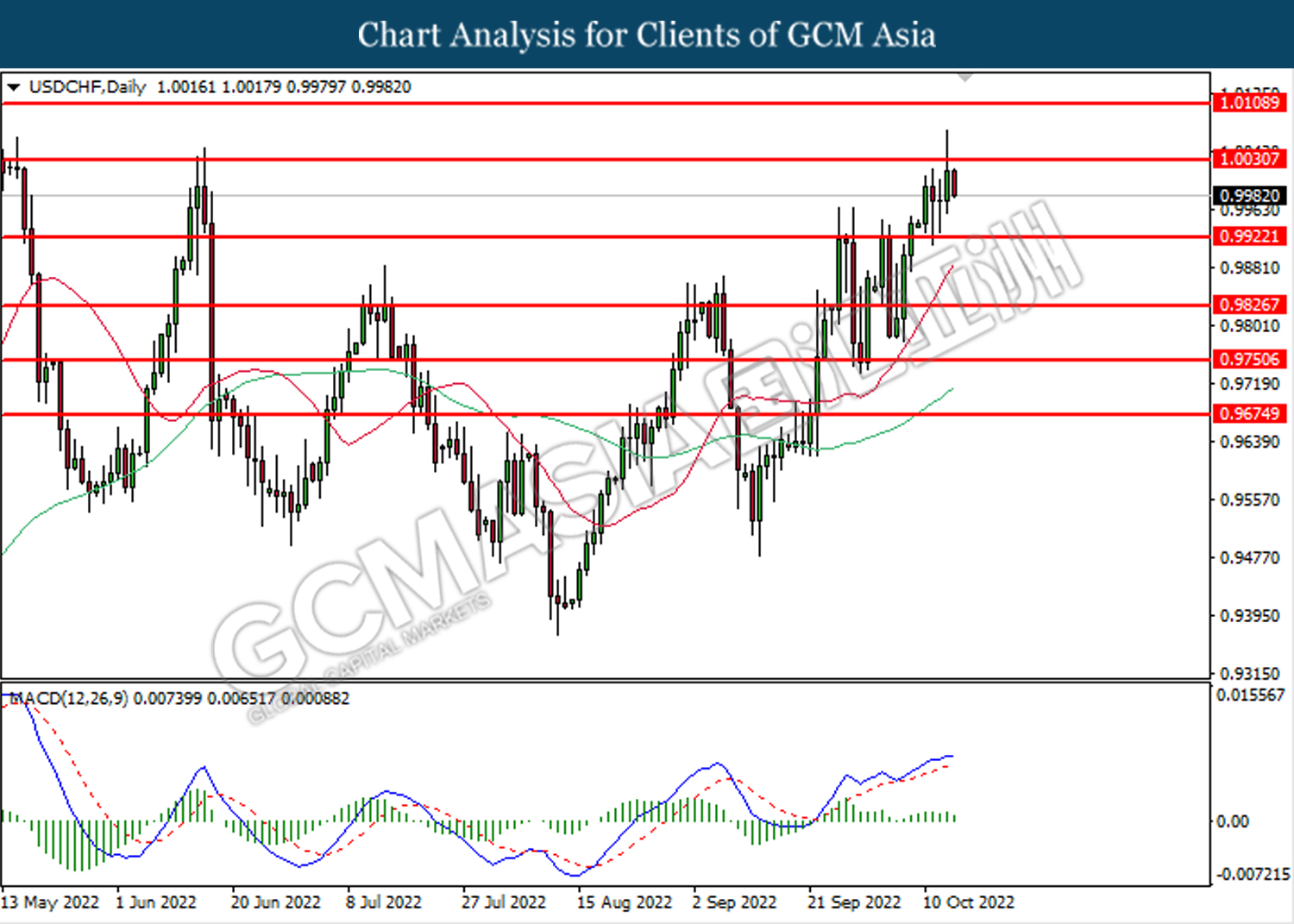

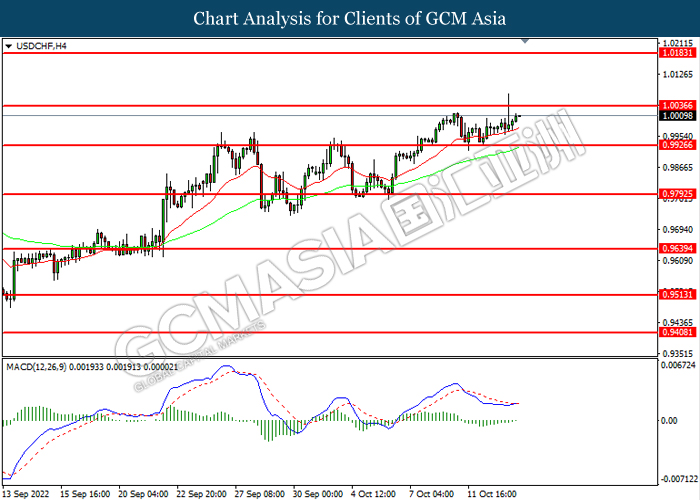

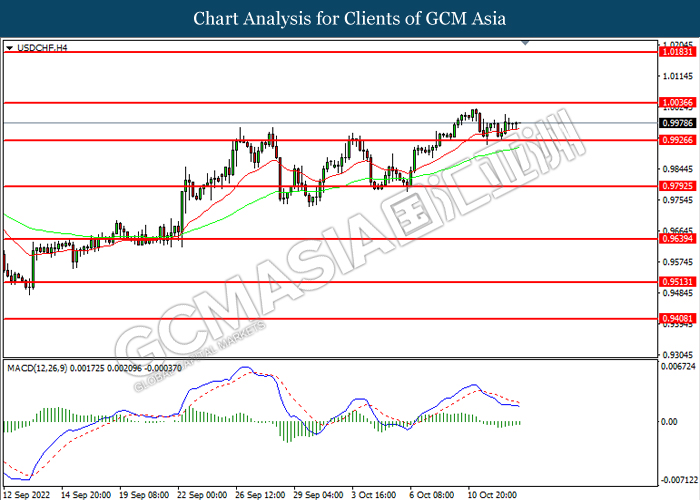

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

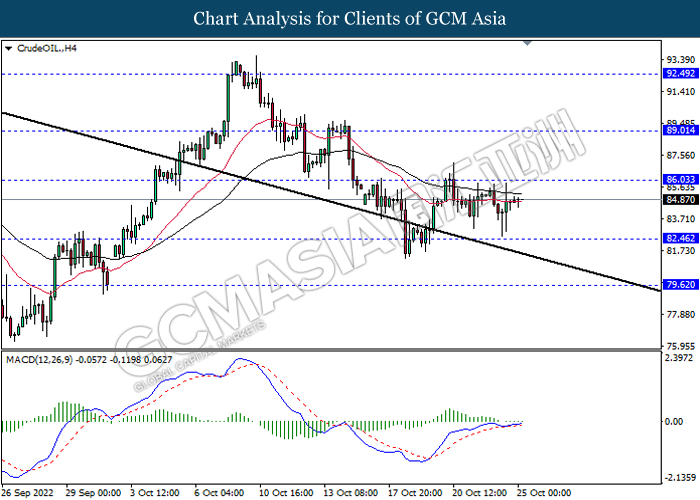

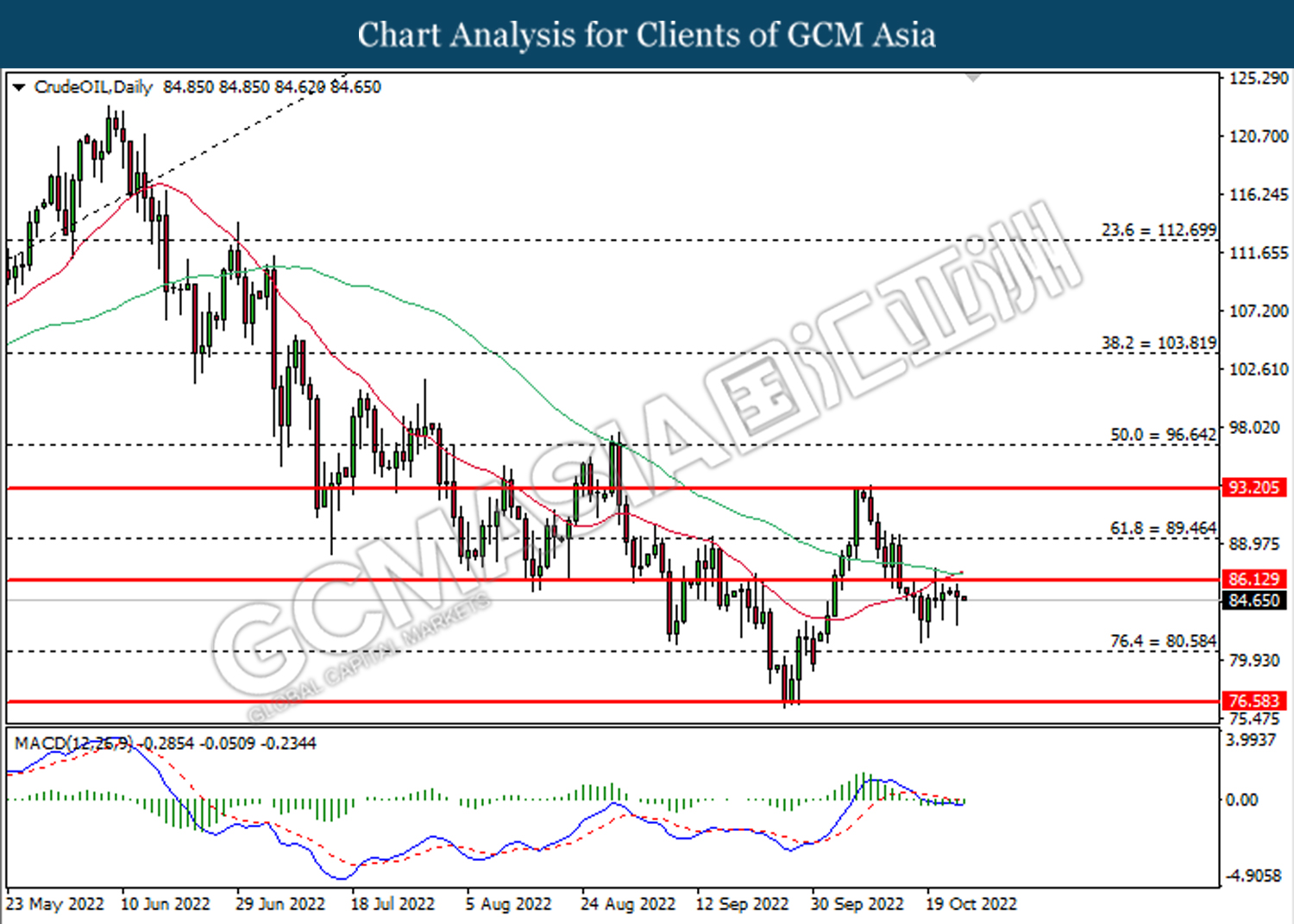

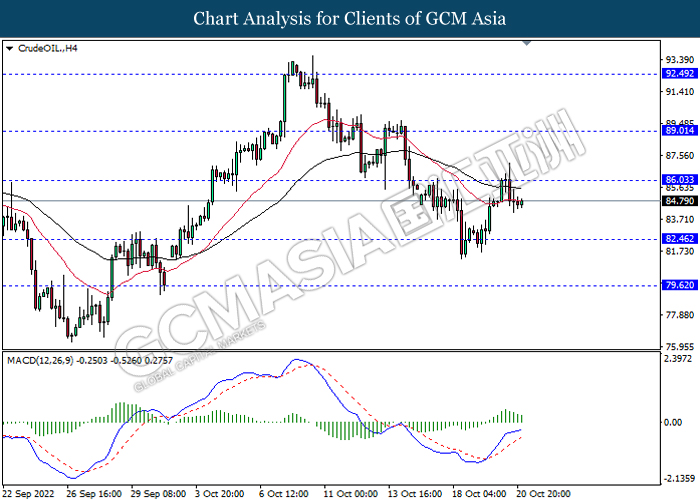

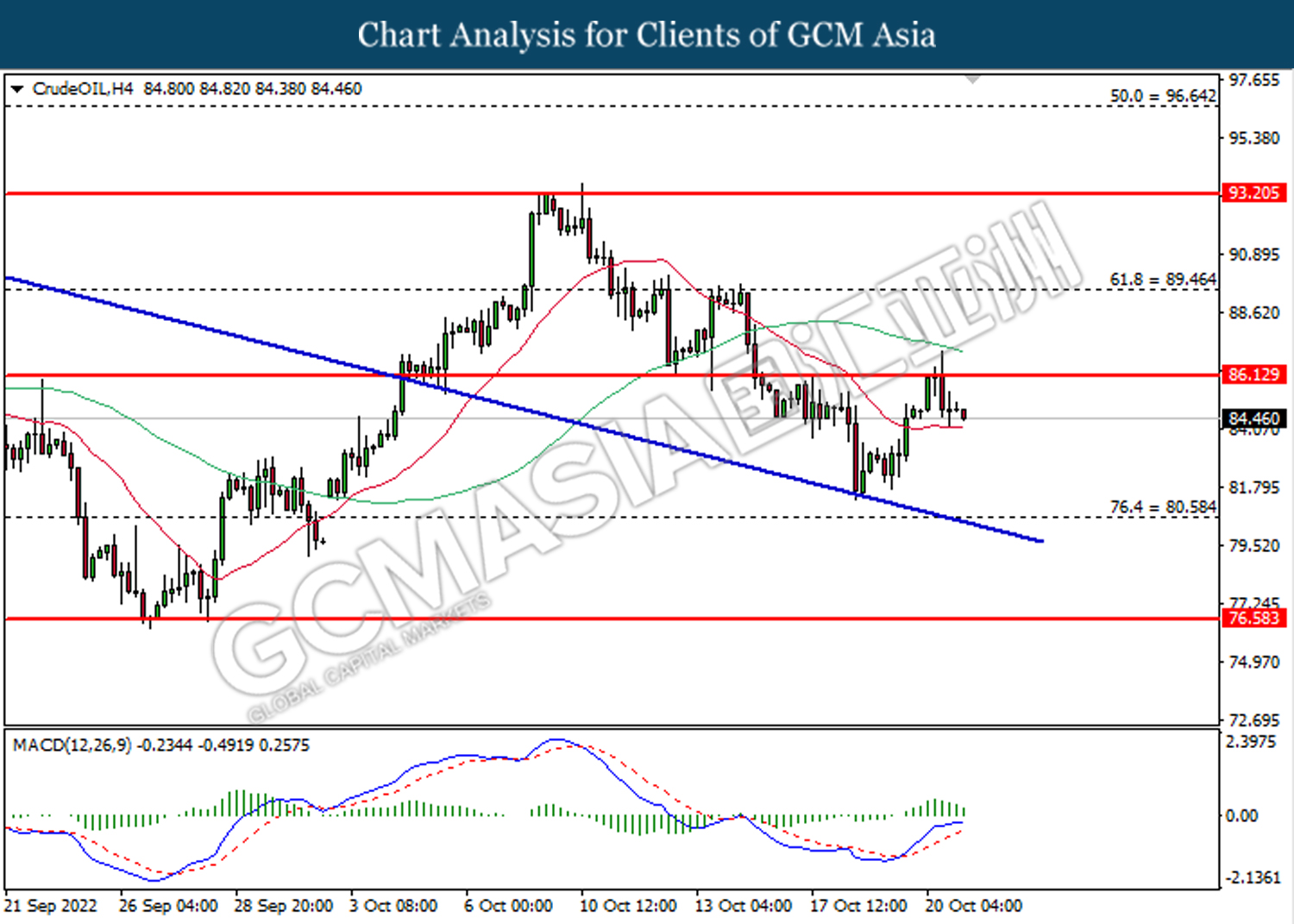

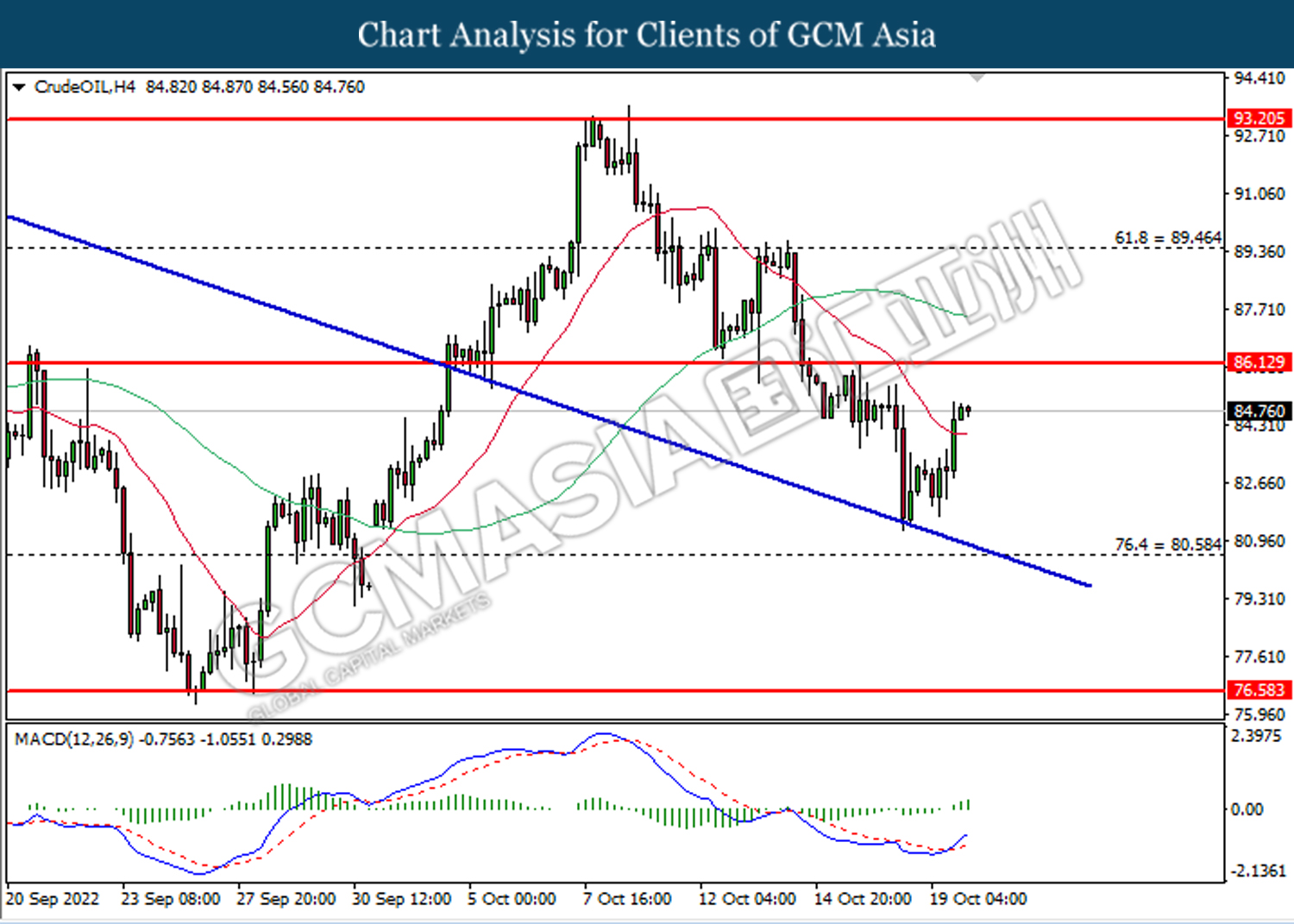

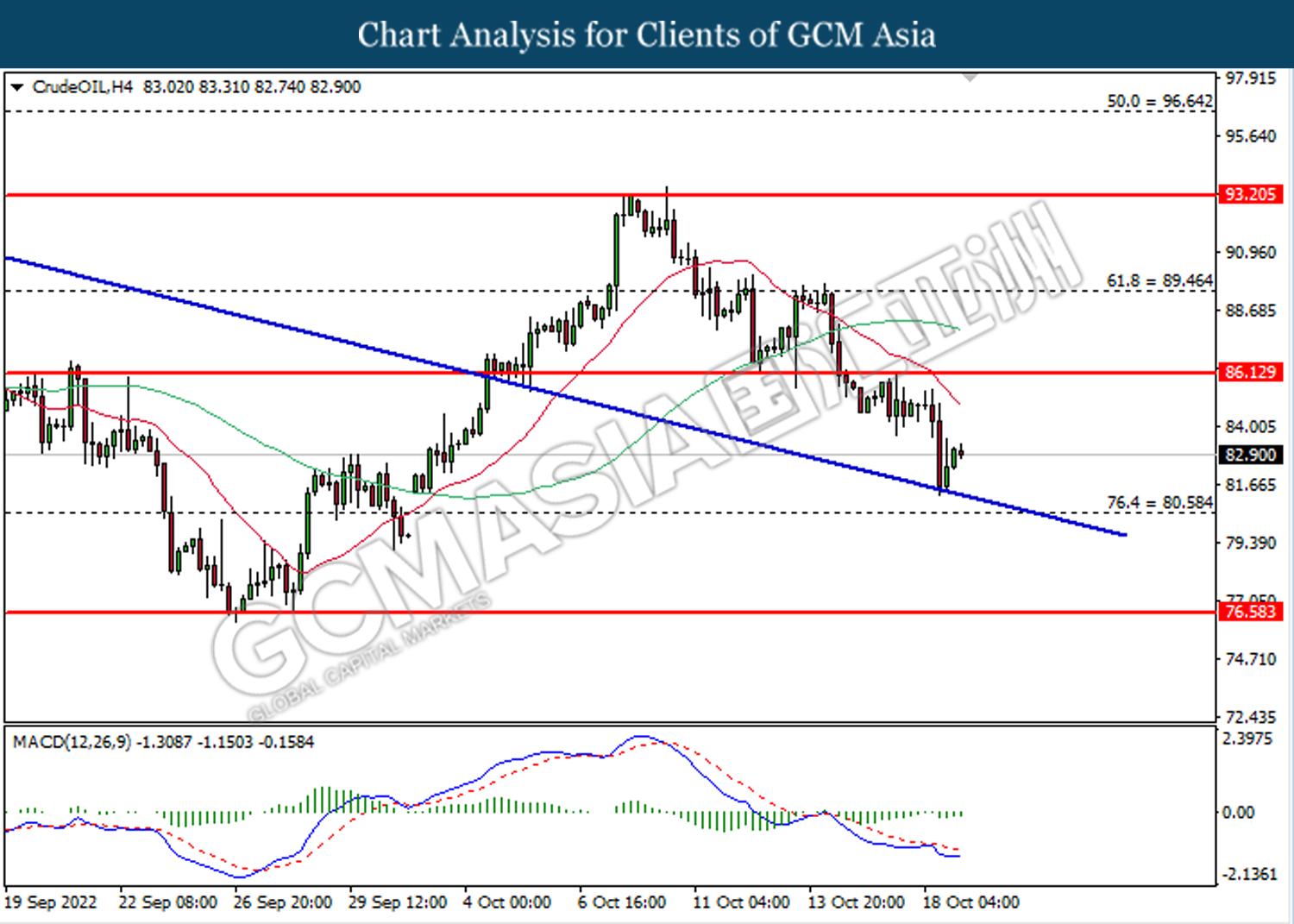

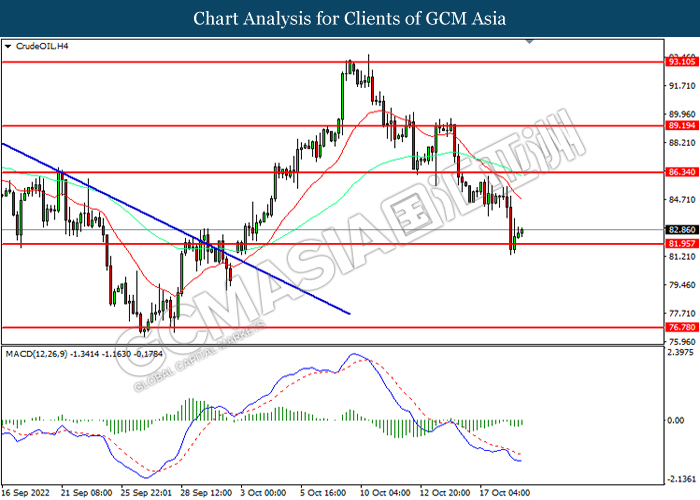

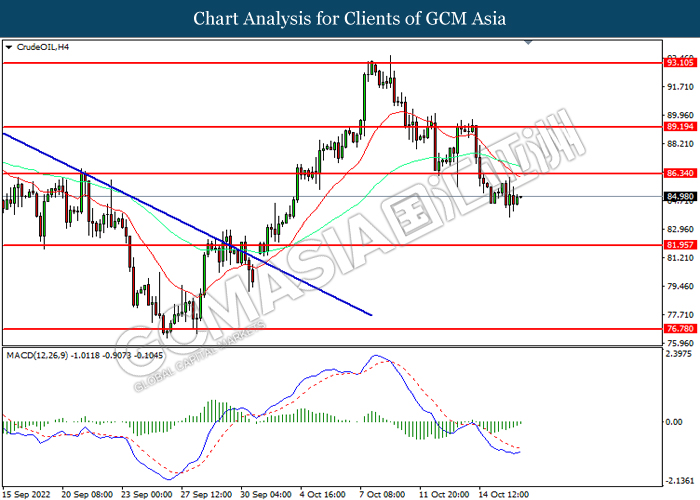

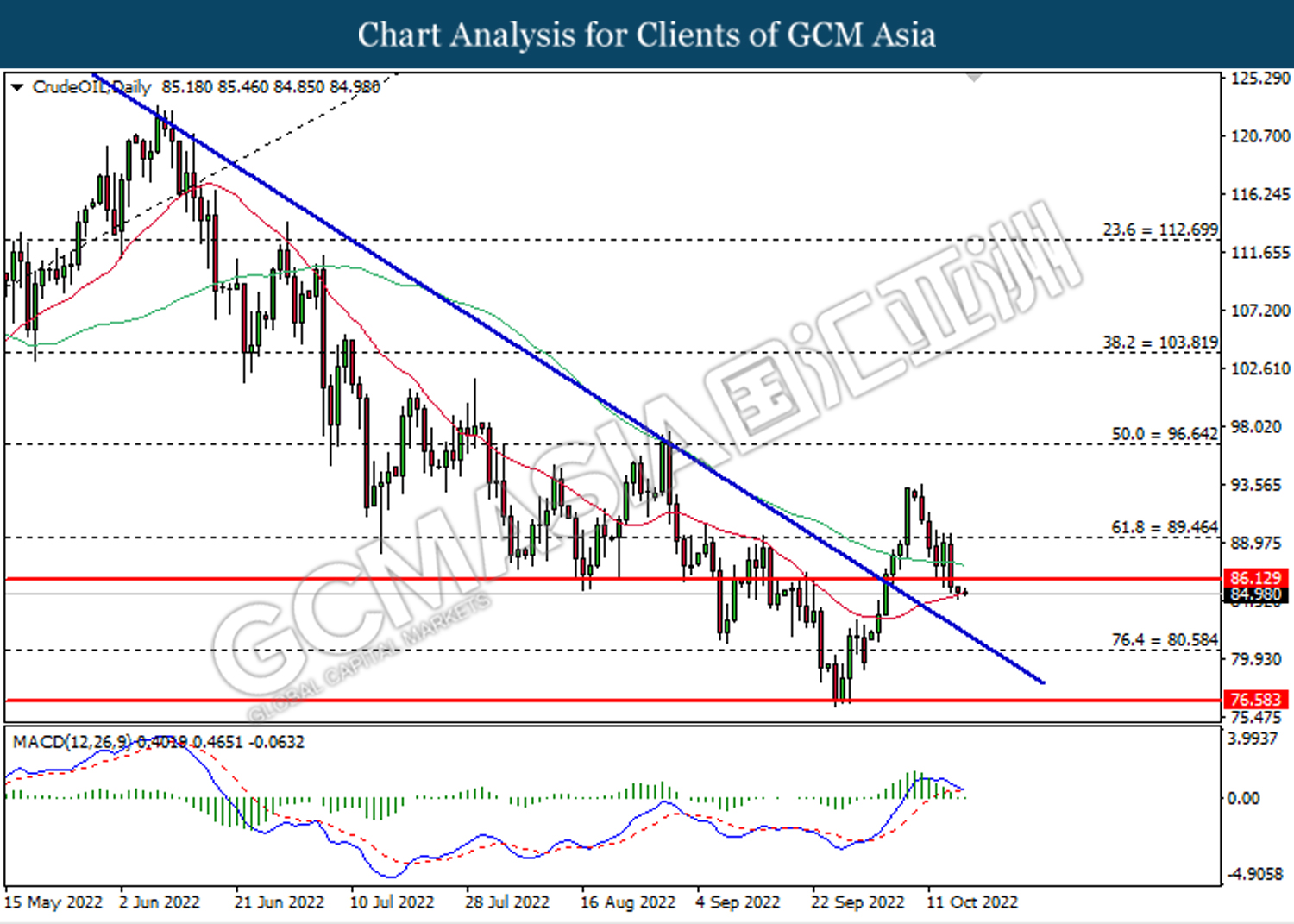

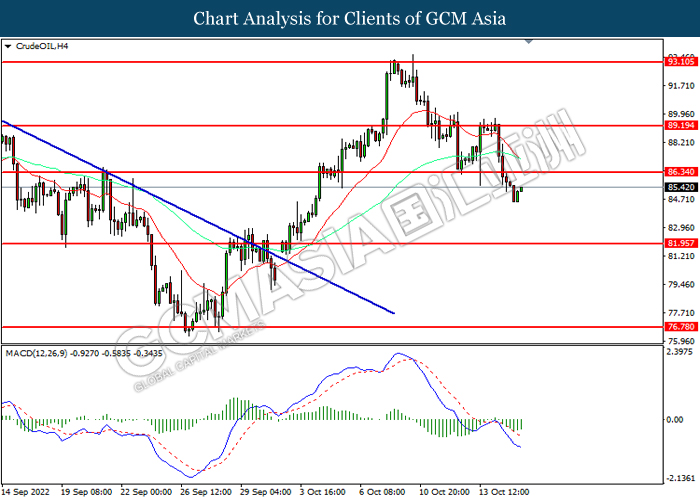

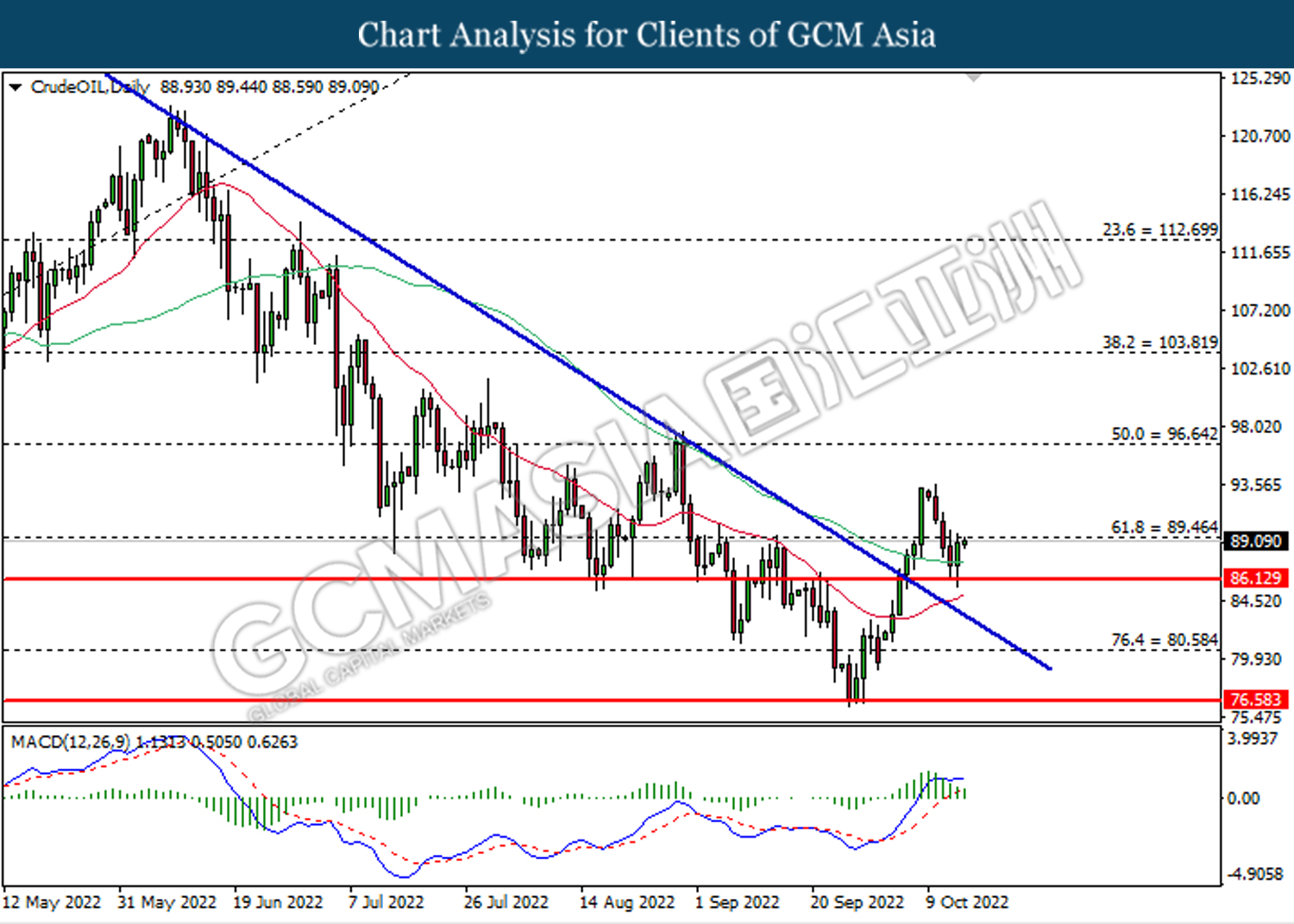

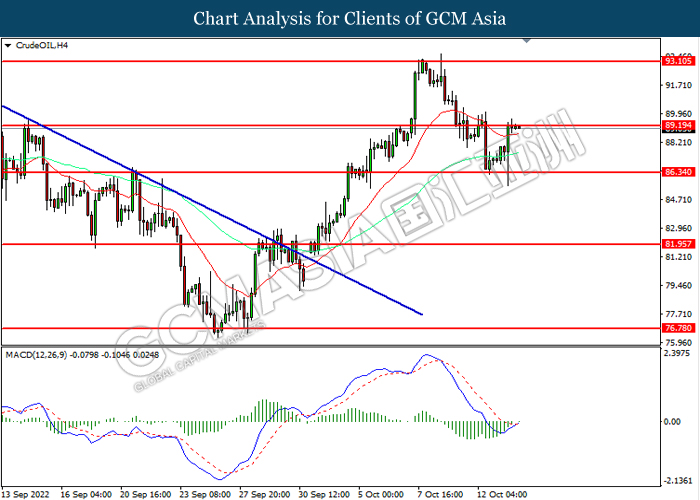

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

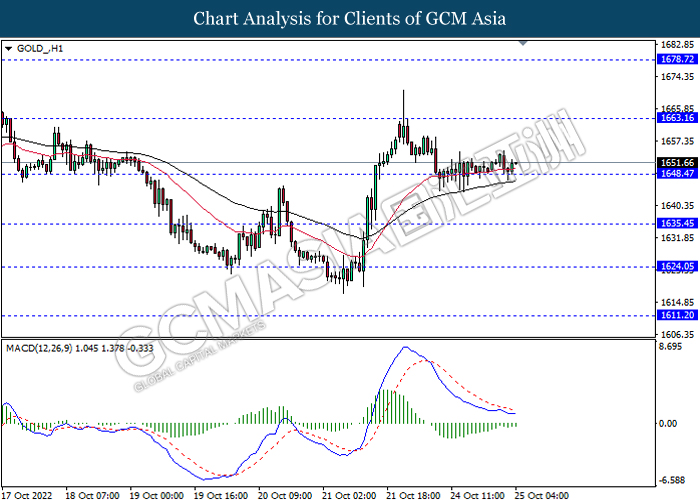

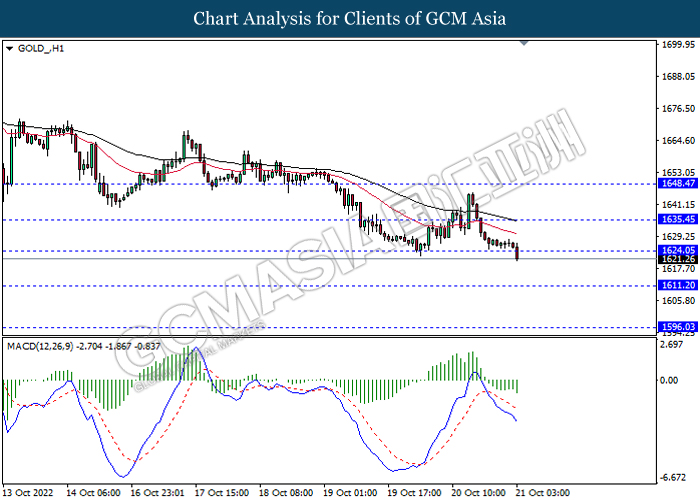

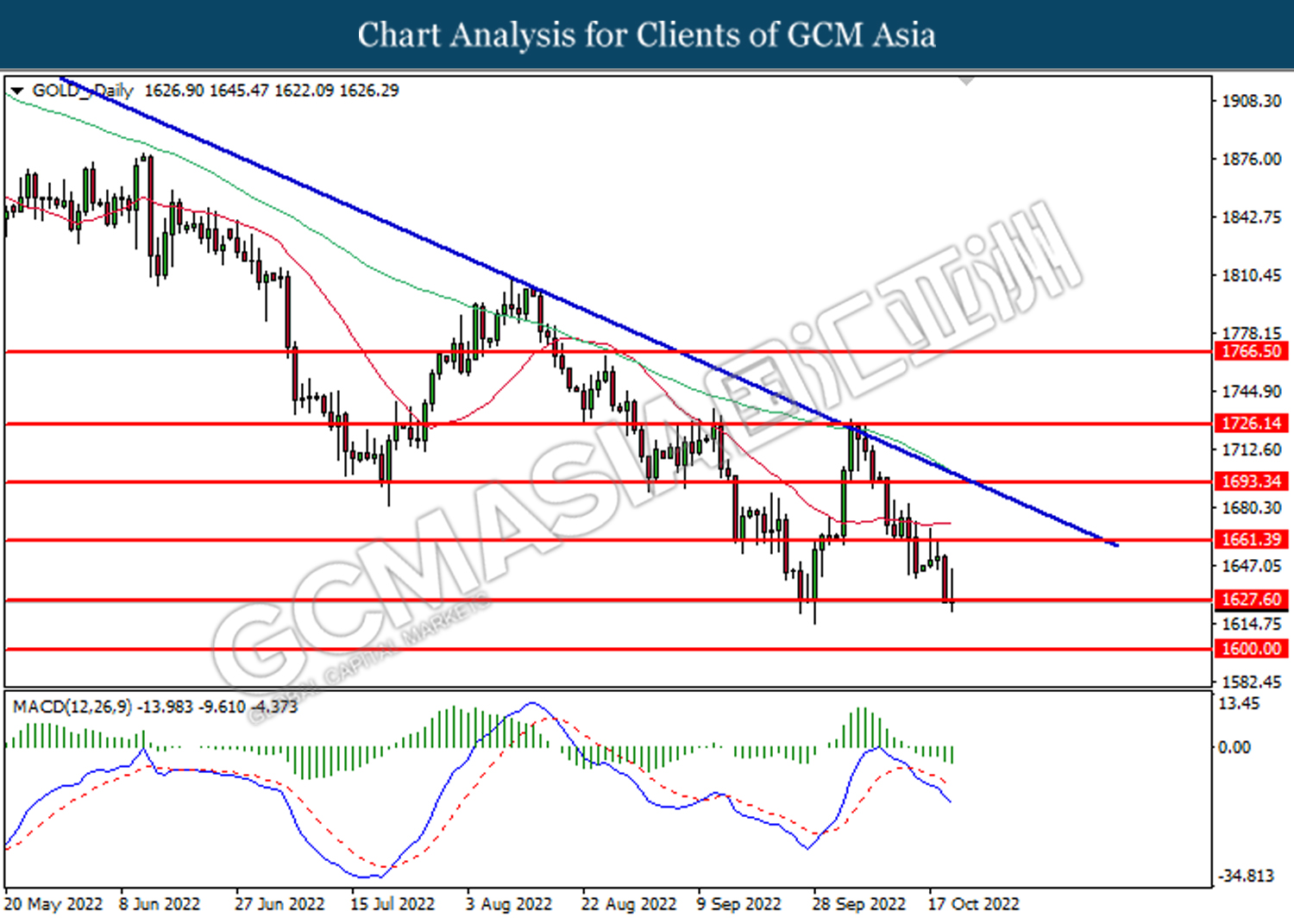

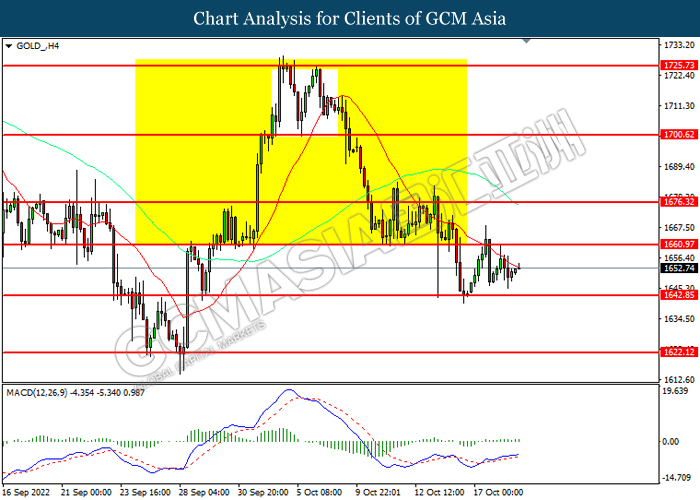

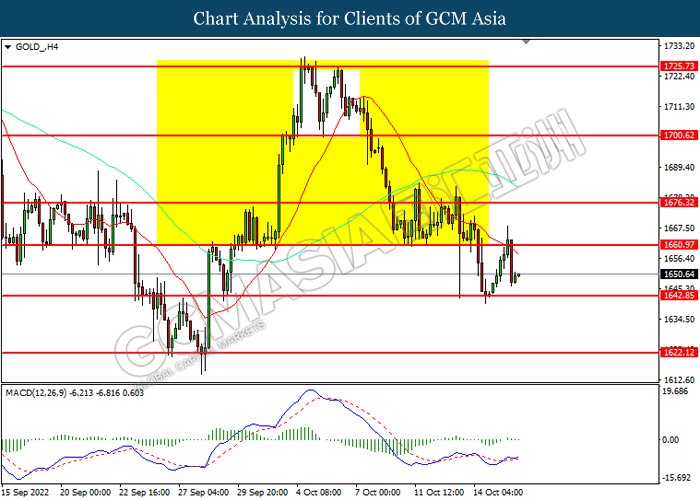

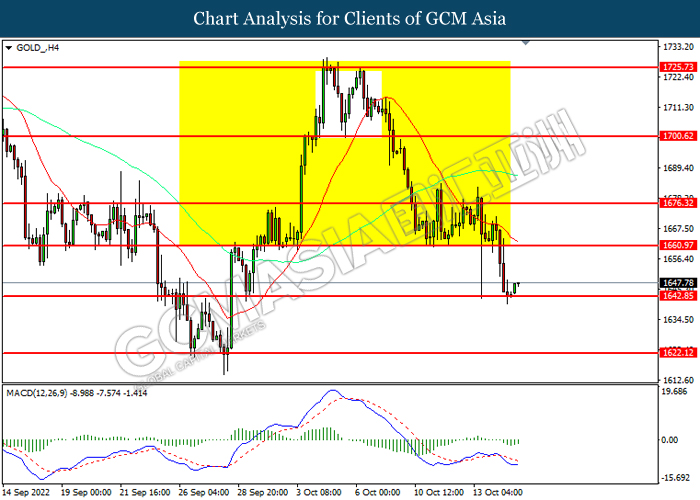

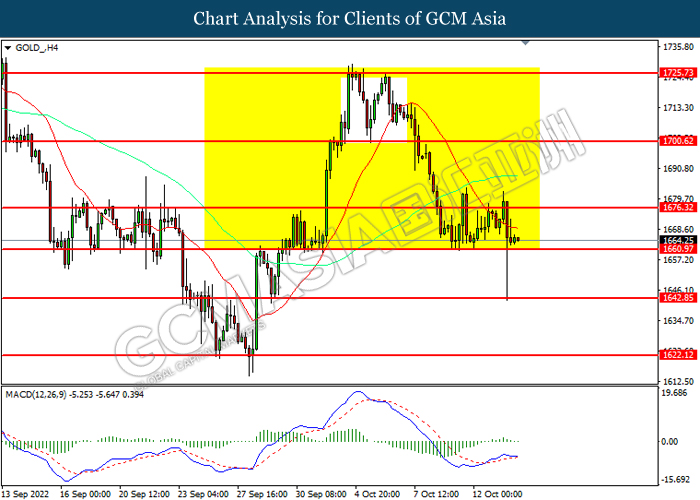

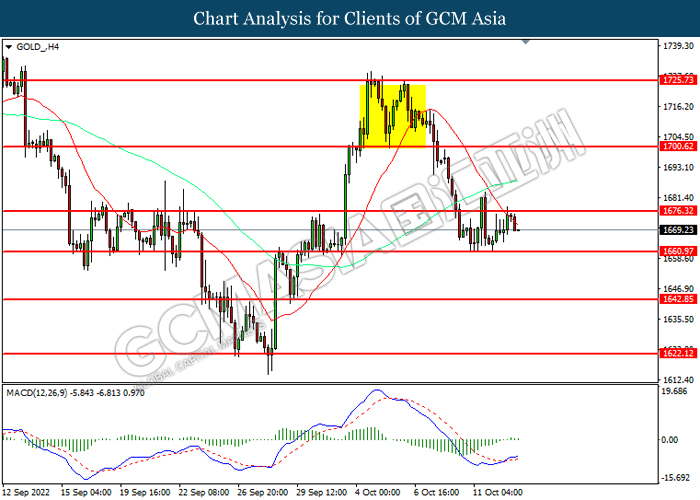

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1633.15, 1678.70

Support level: 1648.45, 1635.45

251022 Morning Session Analysis

25 October 2022 Morning Session Analysis

Pound fall amid downbeat economic data.

The Sterling pound, which is majorly traded by the global investors, pressured by the huge bearish momentum which exerted following the release of a series of downbeat economic data in the nation. According to the Markit Economics, UK Composite Purchasing Managers’ Index (PMI) came in at 47.2, lower than the economist forecast at 48.1, bode well with the recession forecast by the Bank of England. Besides, both the Manufacturing PMI and Services PMI which has been released yesterday also printed a disappointing reading, where they came in at 45.8 and 47.5, missing the consensus forecast at 48.0 and 49.6 respectively. It is noteworthy to highlight that below the level of 50 is being considered as a contraction. On the other side, UK is now in the midst of electing a new prime minister following the resignation of Liz Truss after 6 weeks in office. Following a few days of contest, the former Chancellor of the Exchequer – Rishi Sunak was declared as the next leader of UK Conservative Party, who also set to be the new prime minister to replace Liz Truss. As of writing, the pair of GBP/USD rose 0.24% to 1.1300.

In the commodities market, the crude oil price rose by 0.10% to $84.95 per barrel as China’s economic growth provides fresh hope of oil demand. Besides, the gold prices rose 0.15% to $1651.85 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Oct) | 84.3 | 83.3 | – |

| 22:00 | USD – CB Consumer Confidence (Oct) | 108.0 | 106.5 | – |

Technical Analysis

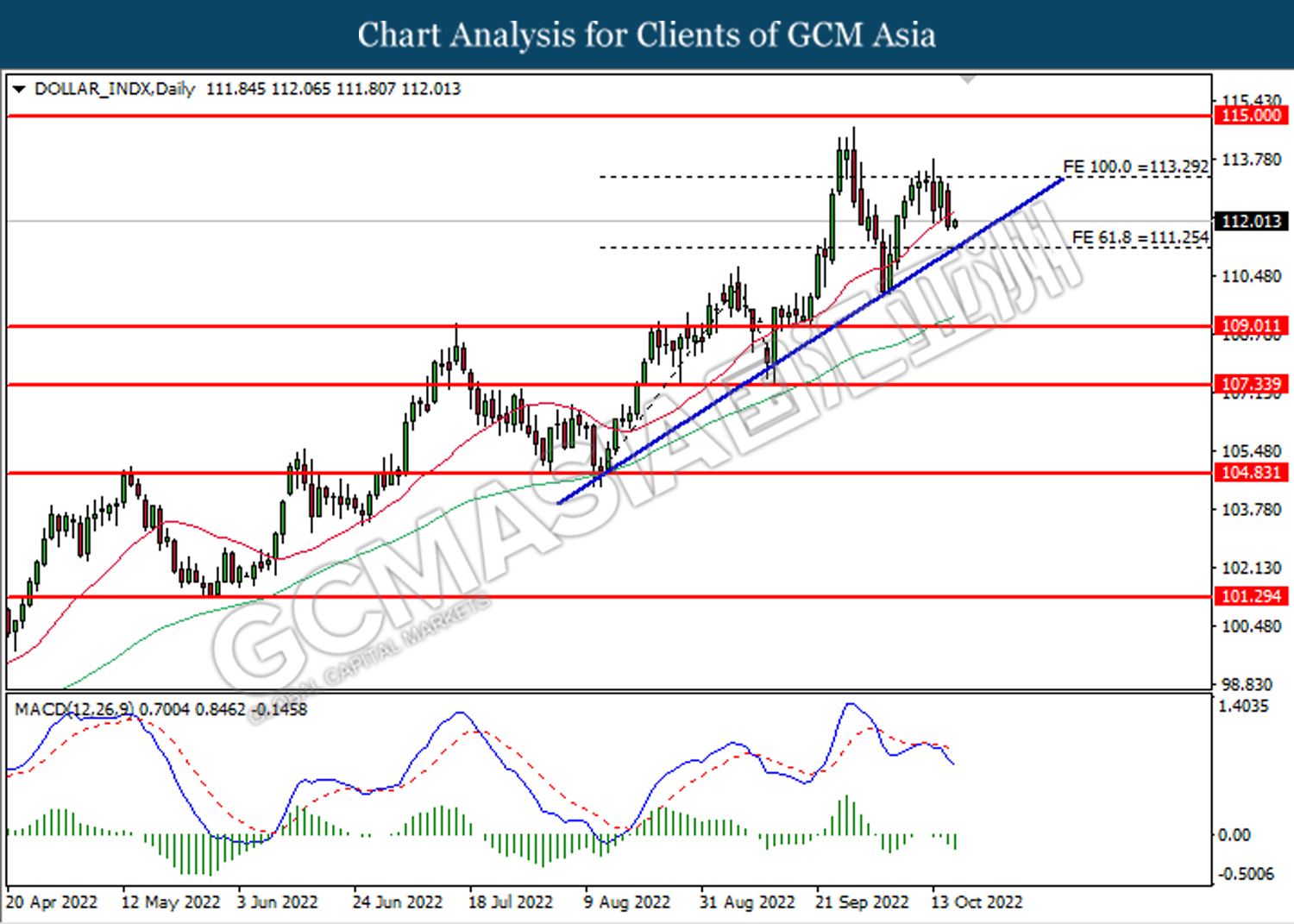

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the trendline.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

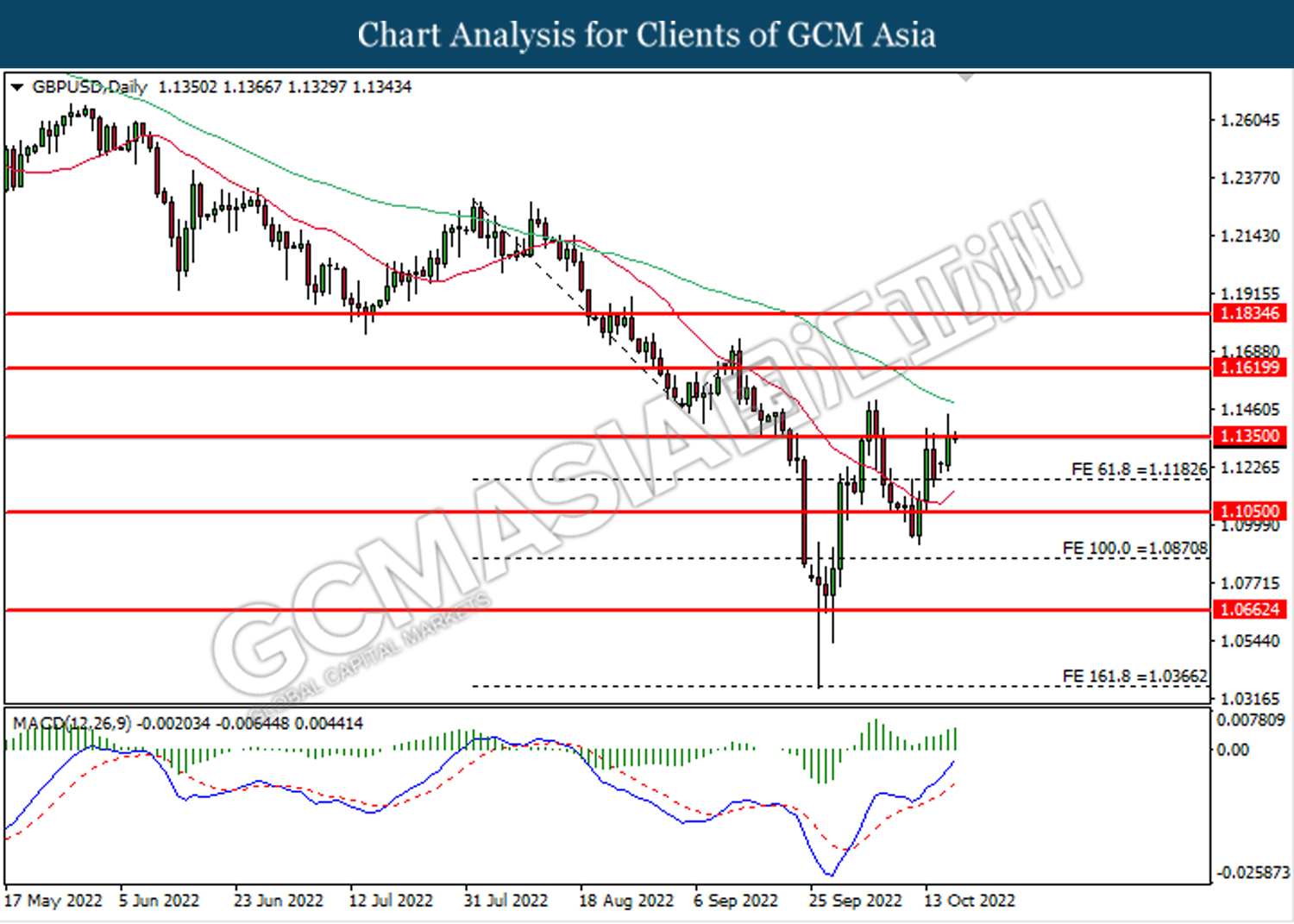

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1440. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1440, 1.1620

Support level: 1.1185, 1.1050

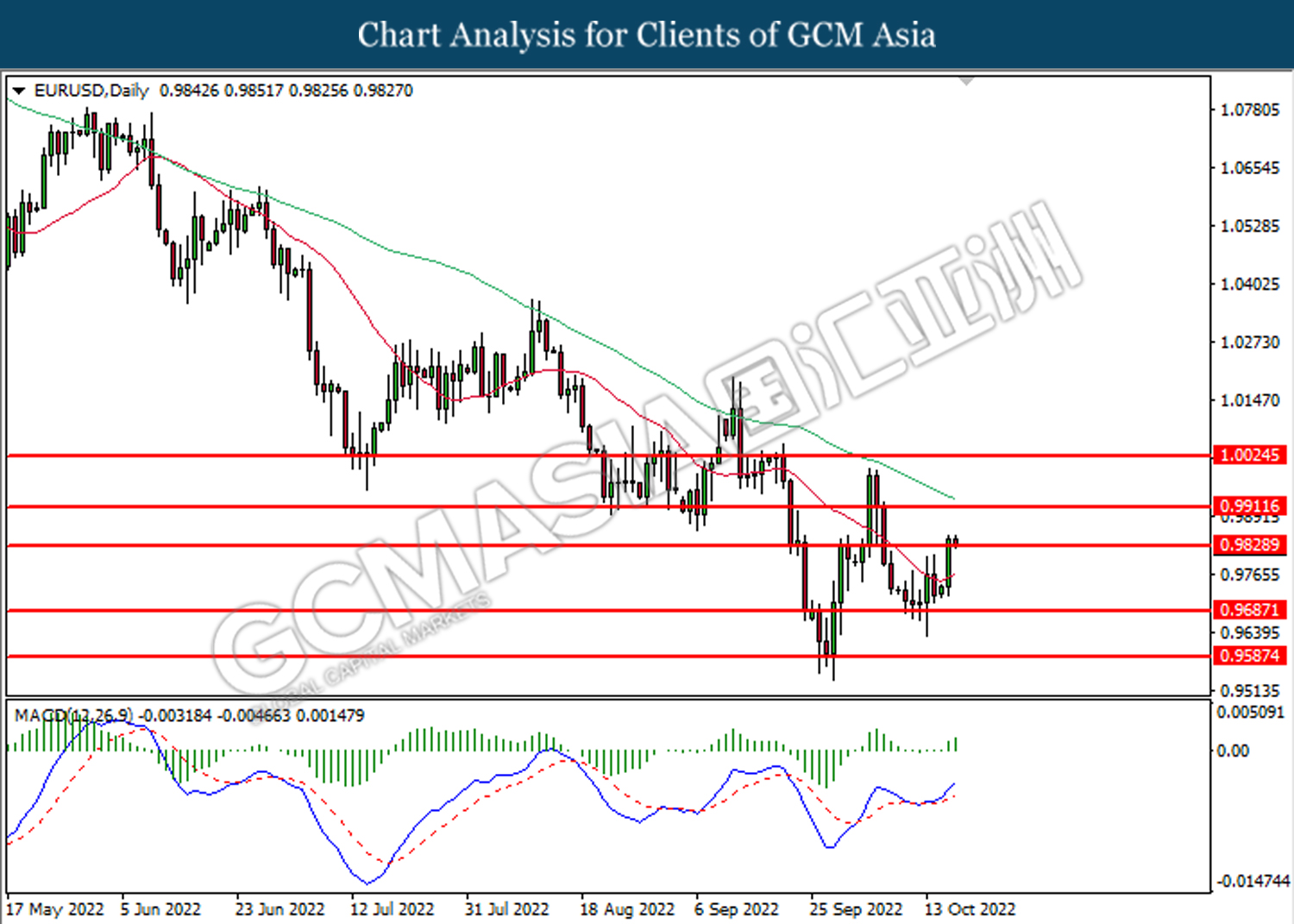

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9830. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9910.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6285.

Resistance level: 0.6400, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.5710. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.5625.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9930. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1661.40. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical rebound in short term toward the resistance level.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00

211022 Afternoon Session Analysis

21 October 2022 Afternoon Session Analysis

US Dollar revived after upbeat economic data released.

The Dollar Index which traded against a basket of six major currencies surged on yesterday amid the upbeat economic data, which spurred bullish momentum toward US Dollar. According to the US Department of Labor, the US Initial Jobless Claims notched down from the previous reading of 226K to 214K, missing the consensus forecast of 230K. Besides, the US Existing Home Sales came in at the figures of 4.71M, exceeding the market expectation of 4.70M. These data shown an optimistic economy condition and labor market, which dialed up the market optimism toward economic progression in the US. Nonetheless, the gains experienced by the US Dollar was limited amid the appreciation of Pound Sterling. Yesterday, Liz Truss has resigned as UK Prime Minister, while she became the shortest serving prime minister in the UK history. As of now, Rishi Sunak and Penny Mordaunt are the front-runners for the next nation Prime Minister, which high hopes were placed on these two candidates to stabilize UK economy headwind. As of writing, the Dollar Index edged up by 0.03% to 112.85.

In the commodities market, the crude oil price appreciated by 0.39% to $84.84 per barrel as of writing after a sharp decline throughout overnight trading session following the rate hike expectation from Fed has weigh down the demand of this black commodity. In addition, the gold price depreciated by 0.46% to $1625.09 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Sep) | -1.6% | -0.5% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Aug) | -3.1% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 113.15, 114.40

Support level: 111.55, 109.95

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9645

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6175

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5725, 0.5805

Support level: 0.5635, 0.5545

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0200

Support level: 1.0005, 0.9930

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1624.05, 1635.45

Support level: 1611.20, 1596.05

211022 Morning Session Analysis

21 October 2022 Morning Session Analysis

Pound jumped following the resignation of Liz Truss.

The Sterling pound, which is majorly traded by the global investors, surged as the British Prime Minister announced her resignation after a brief and chaotic tenure for six weeks. Yesterday, the UK Prime Minister Liz Truss delivered her resignation statement as her economic stimulus program sent shockwaves to the market, led to her party members loss their confidence in her after six weeks of appointment. Liz Truss also admitted that she cannot deliver the mandate on which she was elected by the Conservative Party. With that, she chose to resign as leader of the Conservative Party, but will still remain as prime minister until a successor has been chosen. During her tenure as the UK Prime Minister, she announced a massive package of tax cuts before unwinding most of it in the face of a market rout. At this point in time, a new conservative party leader will replace Liz Truss as new prime minister within a week, whereby no general election will be held soon. As of writing, the pair of GBP/USD dropped 0.03% to 1.1230.

In the commodities market, the crude oil price rose by 0.10% to $84.55 per barrel as China plans to ease the Covid-19 quarantine measures for visitors. However, the market fears over the high inflationary pressures around the world continues to weigh on the oil market outlook. Besides, the gold prices dropped -0.07% to $1627.10 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Sep) | -1.6% | -0.5% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Aug) | -3.1% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1350. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 149.35. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 152.00.

Resistance level: 152.00, 154.95

Support level: 149.35, 147.30

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6285. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6285, 0.6430

Support level: 0.6165, 0.5990

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.5710. However, MACD which illustrated bullish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3715. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical retracement in short term.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 1.0055. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1627.60. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00

201022 Afternoon Session Analysis

20 October 2022 Afternoon Session Analysis

Pound retraced from recent high upon bearish pessimistic economy outlook.

The GBP/USD which traded by majority of investors dropped significantly on yesterday following the economic progression in UK remained clouded. On the economic data front, the UK Consumer Price Index (CPI) YoY in September notched up from the previous reading of 9.9% to 10.1%, exceeding the market forecast of 10%. This crucial inflationary data would likely to lead Bank of England to raise its interest rate in order to stabilize the sky-high inflation. Though, with the downbeat economic data that had been released last week, it hinted that the UK economy started entering into recession. With the rate hike expectation upon weaken UK economy, it would likely to cause another serious issues such as stagflation risk. Thus, it dragged down the value of Pound Sterling. On the other hand, the EUR/USD slumped on yesterday amid the diminishing inflation risk. The Eurozone Consumer Price Index (CPI) YoY posted at the figures of 9.9%, lower than the consensus expectation of 10%. As of writing, the GBP/USD edged up by 0.09% to 1.1224 while EUR/USD rose by 0.10% to 0.9783.

In the commodities market, the crude oil price raised by 1.37% to $85.67 per barrel as of writing, as caution over tightening supply outweighed the negative impact of uncertain demand. In addition, the gold price appreciated by 0.19% to $1633.01 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leader Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 228K | 230K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Oct) | -9.9 | -5.0 | – |

| 22:00 | USD – Existing Home Sales (Sep) | 4.80M | 4.70M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 113.15, 114.40

Support level: 111.55, 109.95

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9645

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6265, 0.6370

Support level: 0.6175, 0.6070

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.5725, 0.5805

Support level: 0.5635, 0.5545

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0200

Support level: 1.0005, 0.9930

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1635.45, 1648.45

Support level: 1624.05, 1611.20

201022 Morning Session Analysis

20 October 2022 Morning Session Analysis

The rising treasury yield pushed the dollar higher.

The dollar index, which traded against a basket of six major currencies, managed to pare its losses after consolidating for few trading sessions amid the rising treasury yield. At the moment, the benchmark 10-year Treasury yield hit the highest level in 14 years as the market participants are expecting the Federal Reserve to increase the interest rate aggressively in the upcoming meeting, in order to cool down the overheating economy. According to the CME FedWatch Tool, the probability of a 75-basis point rate hike is about 94.5%, far higher than the 1-week ago reading. On the other sides, a series of upbeat economic data which have been released during the past few weeks showed that the US labor market remained resilience, while there was no sign of recession at this point of time. With that, it actually provides more room for the Federal Reserve to hike the cash rate in a more aggressive way. As of writing, the dollar index rose 0.67% to 112.90.

In the commodities market, the crude oil price rose by 2.21% to $85.90 per barrel following some crude oil draw in the US EIA data yesterday night. According to the EIA, US Crude Oil Inventories data dropped by -1.725M, missing the economist forecast at 1.380M. Besides, the gold prices dropped 0.06% to $1628.20 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leader Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 228K | 230K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Oct) | -9.9 | -5.0 | – |

| 22:00 | USD – Existing Home Sales (Sep) | 4.80M | 4.70M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1350. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 149.35. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after its candle successfully closes above the resistance level.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6285. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.5710. However, MACD which illustrated bullish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3715. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical retracement in short term.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 1.0055. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the downward trendline. MACD which illustrated bullish bias momentum momentum suggests the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1627.60. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00

191022 Afternoon Session Analysis

19 October 2022 Afternoon Session Analysis

Pound ‘stick’ on the ceiling amid BoE start selling bonds.

The Pound Sterling, which was majorly traded by the global investors hovered near the highest level in 2-week after the Bank of England (BoE) announced to start selling bonds. Yesterday, BoE said it would start selling some of its short-term and medium-term UK government bonds from 1st November. However, the plan ruled out the longer-duration bonds selling activity following the recent storm in the British government bond market. Since the outbreak of the Covid-19 crisis, the central bank has been implementing easing monetary policy, where they acquired government bond more than usual to help the economy tide through the pandemic. With that, the BoE and UK government are now in the same position to tackle the sky-high inflation, where both the tightening monetary and fiscal policies are expected to cool down the overheating economy. As of writing, the pair of GBP/USD rose 0.25% to 1.1345.

In the commodities market, the crude oil price rose by 0.07% to $84.10 per barrel following some crude oil draw in the API data early today. Besides, the gold prices dropped 0.12% to $1649.95 per troy ounce following the dollar’s rebound.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Sep) | 9.90% | 10.00% | – |

| 17:00 | GBP – CPI (YoY) (Sep) | 9.10% | 10.00% | – |

| 20:30 | USD – Building Permits (Sep) | 1.542M | 1.530M | – |

| 20:30 | CAD – Core CPI (MoM) (Sep) | 0.00% | – | – |

| 22:30 | USD – Crude Oil Inventories | 9.880M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1350. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9830. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9910.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6285. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6430.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5710. MACD which illustrated bullish bias momentum suggest the pair to extend gains after it successfully breakout above the resistance level at 0.5710.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3715. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9930. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0030, 1.0110

Support level: 0.9930, 0.9840

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the downward trendline. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 1661.40.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00

191022 Morning Session Analysis

19 October 2022 Morning Session Analysis

Risk-on sentiment following upbeat report, safe-haven Dollar retreated.

The Dollar Index which traded against a basket of six major currencies extend its losses following the revival of risk appetite in the global financial markets continue to prompt investors to shift their portfolio into another riskier asset. Yesterday, the US equity market surged significantly as the upbeat earnings and better-than-expected factory data, which spurring further positive prospect toward the upcoming financial reports. Nonetheless, the losses experienced by the US Dollar was limited over the backdrop of upbeat manufacturing data. According to Federal Reserve, US Industrial Production for last month came in at 0.4%, higher than the market forecast at 0.1%. Such upbeat production data in September led by output gains in both durable and nondurable goods, indicating the manufacturing sector in United States still remains solid despite the recent rate hike decision from Federal Reserve. As of writing, the Dollar Index depreciated by 0.04% to 112.00.

In the commodities market, the crude oil price extends its losses by 0.52% to 83.60 per barrel as of writing. The crude oil price was edged lower amid the speculation over the oil release from US government. According to Bloomberg, the Biden administration is planning to release of at least another 10 million to 15 million barrels of oil from Strategic Petroleum Reserve (SPR). On the other hand, the gold price surged by 0.10% to $1653.50 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Sep) | 9.90% | 10.00% | – |

| 17:00 | GBP – CPI (YoY) (Sep) | 9.10% | 10.00% | – |

| 20:30 | USD – Building Permits (Sep) | 1.542M | 1.530M | – |

| 20:30 | CAD – Core CPI (MoM) (Sep) | 0.00% | – | – |

| 22:30 | USD – Crude Oil Inventories | 9.880M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 112.20, 113.15

Support level: 111.35, 109.95

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.5925, 0.6170

Support level: 0.5570, 0.5315

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.4035, 1.4360

Support level: 1.3500, 1.3145

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.35, 89.20

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1660.95, 1676.30

Support level: 1642.85, 1622.10

181022 Afternoon Session Analysis

18 October 2022 Afternoon Session Analysis

Japanese Yen sank despite high possibility of intervention by Japan government.

The Japanese Yen, which is majorly traded by the global investors, plunged as the Bank of Japan continues to maintain its ultra-loosening monetary policy despite the sky-high inflationary pressures in the nation. The Japan’s contradictory stance leaves yen at risk of further slide, whereby the other major central bank such as Federal Reserve, Bank of England and European Central Bank hiked their interest rate aggressively to calm down the overheating economy. After the Japanese Yen suffering a tremendous depreciation for quite some time, the Japan’s government vowed that they are closely watching the FX moves with a high sense of urgency and appropriate steps will be taken if necessary. Back to few weeks ago, Japan’s government intervened the FX market by selling the USD and buying the Japanese Yen concurrently. Such a move had pushed down the value of USD/JPY by roughly about 500 pips. Therefore, going forward, the market participants will continue to eyes on the further comment and action of the Bank of Japan to scrutinize the movement of Japanese Yen. As of writing, the pair of USD/JPY edged down by 0.06% to 148.95.

In the commodities market, the crude oil price dipped 0.41% to $85.50 per barrel amid the heightening of market fears over the rising covid-19 cases in China, which could deteriorate the oil demand in the future. Besides, the gold prices dropped 0.04% to $1649.95 per troy ounce as the dollar’s strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Oct) | -61.9 | -65.7 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1350. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9830. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9910.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6285. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6285, 0.6430

Support level: 0.6165, 0.5990

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5625. MACD which illustrated bullish bias momentum suggest the pair to extend gains toward the resistance level at 0.5710.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3715. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 1.0030. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9930.

Resistance level: 1.0030, 1.0110

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 86.15. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 1661.40.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00

181022 Morning Session Analysis

18 October 2022 Morning Session Analysis

Pound surged as UK fiscal policy U-turned.

Pound Sterling rebounded from its lower level following the UK new Finance Minister announced a comprehensive retreat on the UK government’s tax and spending plans on Monday in order to calm the jittery markets and restore investor confident toward the government’s credibility. According to CNBC, the UK Finance Minister Jeremy Hunt announce that almost all of the controversial tax measures which announced earlier would be reversed. The major U-turn includes scrapping the cut for the lowest rate of income tax as well as reduction on dividend tax rates. The stunning reversal would likely to raise about $36 billion for the UK budget. The announcement had eased market concerns toward the financial capability for the UK government, increasing the appeal for the UK government bond. As of writing, GBP/USD depreciated by 0.01% to 1.1355.

In the commodities market, the crude oil price appreciated by 0.23% to $84.95 per barrel as of writing. The oil market rebounded from its lower level as more OPEC+ members expressed their willingness to support for the recent production cut of over 2 million barrels per day. On the other hand, the gold market extends its losses by 0.01% to $1650.50 per troy ounces as of writing amid rate hike expectation from Federal Reserve continue to drag down the appeal for this safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Oct) | -61.9 | -65.7 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 112.20, 113.15

Support level: 111.35, 109.95

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5925, 0.6170

Support level: 0.5570, 0.5315

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.4035, 1.4360

Support level: 1.3500, 1.3145

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.35, 89.20

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its lsoses.

Resistance level: 1660.95, 1676.30

Support level: 1642.85, 1622.10

171022 Afternoon Session Analysis

17 October 2022 Afternoon Session Analysis

Pound gap up after huge U-turn announced.

The Pound Sterling, which was widely traded by global investors, jumped after the new prime minister Liz Truss reversed its tax-cut plan. Last Friday, Truss scrapped the pledge to reverse predecessor Boris Johnson’s hike of corporation tax from 19% to 25%, which could restore a huge amount of revenue to the UK government. Earlier this month, the UK government has scrapped its tax-cut plan after a substantial public backlash. Besides, Liz Truss also has decided to fire the finance minister Kwasi Kwarteng amid mounting political pressure and market chaos. For the replacement, a former health secretary and foreign secretary Jeremy Hunt will succeed the position as the next finance minister. Following the big U-turn in the fiscal monetary policy, market participants are seeing the effort of UK government and Bank of England (BoE) in tackling the sky-high inflation, aiming to cool down the overheating economy despite the risk of economic recession. As of writing, the pair of GBP/USD rose by 0.57% to 1.1234.

In the commodities market, the crude oil price edged up 0.38% to $86.15 per barrel but the overall trend remains bearish amid the mounting of China Covid-19 cases. Besides, the gold prices edged up 0.40% to $1650.50 per troy ounce amid a slight retracement in the dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1185. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1350.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 0.9685. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9830.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6165. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6285.

Resistance level: 0.6285, 0.6430

Support level: 0.6165, 0.5990

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5565. MACD which illustrated bullish bias momentum suggest the pair to extend gains toward the resistance level at 0.5625.

Resistance level: 0.5625, 0.5710

Support level: 0.5560, 0.5500

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3875. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3715.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 1.0030. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0110, 1.0160

Support level: 1.0030, 0.9930

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 1661.40.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00

171022 Morning Session Analysis

17 October 2022 Morning Session Analysis

US Dollar surged, supported by upbeat data.

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of bullish economic data from US region last week. According to Census Bureau, US Core Retail Sales for last month notched up significantly from the preliminary reading of -0.1% to 0.1%, exceeding the market forecast at -0.1%. In addition, a survey from University of Michigan on Friday also indicated that US Michigan Consumer Sentiment had improved further in October, which increasing from the previous reading of 58.6 to 59.8, better than the market forecast at 59.0. Nonetheless, Investors would continue to scrutinize the US housing market this week, where the increase in interest rate has already jeopardized the housing demand. As of writing, the Dollar Index appreciated by 0.01% to 113.05.

In the commodities market, the crude oil price retreated by 0.05% to 85.20 per barrel as of writing as the rising global recession risk continue to drag down the appeal for this black-commodity. On the other hand, the gold price depreciated by 0.05% to $1647.55 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 113.15, 114.35

Support level: 112.20, 111.35

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5925, 0.6170

Support level: 0.5570, 0.5315

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.4035, 1.4360

Support level: 1.3500, 1.3145

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.35, 89.20

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1660.95, 1676.30

Support level: 1642.85, 1622.10

141022 Afternoon Session Analysis

14 October 2022 Afternoon Session Analysis

Liz Truss intends to scrap the tax-cut plan.

The Pound Sterling, which was widely traded by global investors, skyrocketed following the news reported that the new UK government is in talks of scrapping the tax-cut plan. Earlier last week, Liz Truss’s government announced a series of tax cut plan to ease the rising cost of living in the household in the UK. However, the UK government are now considering making a U-turn on the tax-cut plan following a growing public backlash. In terms of economics wise, investors reckon that the tax-cut plan may eventually exacerbate the recession risk in the UK as it may push up the UK budget deficit. With that, it diminished the investors’ confidence in the development of the UK economy. However, the news of reversing the tax-cut plan revived the market sentiment in the UK. As of now, investors are all eyeing the bond-purchasing program, which is scheduled to end today. Any extension of the emergency bond purchasing plan would likely support the economy through the economic recession. As of writing, the pair of GBP/USD rose 0.04% to 1.1333.

In the commodities market, the crude oil price edged up 0.06% to $89.40 per barrel following the depreciation of the dollar index, which dragged down the cost of oil for non-US buyers. Besides, the gold prices were up 0.06% to $1667.45 per troy ounce amid a weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Sep) | -0.3% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Sep) | 0.3% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1350. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1350, 1.1620

Support level: 1.1050, 1.0870

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 0.9685. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9830.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6285. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6430.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5625. MACD which illustrated bullish bias momentum suggest the pair to extend gains toward the resistance level at 0.5710.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5565

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3715. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3855, 1.4000

Support level: 1.3715, 1.3600

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 1.0030. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9920.

Resistance level: 1.0030, 1.0110

Support level: 0.9920, 0.9825

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 96.65

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1661.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60

141022 Morning Session Analysis

14 October 2022 Morning Session Analysis

US Dollar seesawed following the released of crucial CPI data.

The Dollar Index which traded against a basket of six major currencies whipsawed on yesterday following the released of spiking inflation data from United State region. According to US Bureau of Labor Statistics, US Consumer Price Index (CPI) YoY came in at 8.2%, exceeding the market forecast at 8.1%. Such upbeat inflation data had insinuated greater expectation for the Federal Reserve to continue on its aggressive path of rate hike decision during the FOMC meeting in early November. As for now, the Fed fund futures have speculated in a 9.1% probability of a 100-basis point rate hike and another 90.9% probability of a 75 basis-point increase during the next month’s Federal Reserve policy meeting. Nonetheless, the gains experienced by the US Dollar was limited by the negative job data. The US Initial Jobless Claims came in at 228K, worse than the market forecast at 225K, according to Department of Labor. As of writing, the Dollar Index depreciated by 0.76% to 112.30.

In the commodities market, the crude oil price surged 0.05% to $89.20 per barrel as of writing. The oil market rebounded significantly yesterday amid the depreciation of US Dollar yesterday urged the non-US oil buyer to repurchase this black-commodity. On the other hand, the gold market dipped by 0.09% to $1664.55 per troy ounces as of writing as market participants speculated a more aggressive rate hike decision from the Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Sep) | -0.3% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Sep) | 0.3% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

NZDUSD, Weekly: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 0.5925, 0.6170

Support level: 0.5605, 0.5315

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 89.20, 93.10

Support level: 86.35, 81.95

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85

131022 Afternoon Session Analysis

13 October 2022 Afternoon Session Analysis

Yen tumbled as stagflation risk continue hovered in financial market.

The Japanese Yen extend its losses on Thursday, currently hovering its weakest level in 32 years following the released higher-than-expected inflation reading from United States, prompting the widening the interest differential between Japan and US Treasury yield. Nonetheless, the losses experienced by the Japanese Yen was limited by the expectation upon the currency intervention from Bank of Japan as the Japanese Policymakers continued to warn against significant depreciation of Japanese Yen. On the economic data front, Bank of Japan (BoJ) reported that the current Japan Producer Price Index (PPI) notched up significantly from the previous reading of 9.4% to 9.7%, exceeding the market forecast at 8.8%. Given that most businesses have taken to passing on high material costs to customers, the Japan’s consumer price index is currently trending at an eight-year high. As of writing, USD/JPY appreciated by 0.01% to 146.85.

In the commodities market, the crude oil price slumped 0.03% to $87.10 per barrel as of writing. The oil market edged lower amid weakening global demand outlook following both OPEC+ and the US Energy Department have cut their demand outlooks, diminishing the appeal for the demand of this black-commodity. On the other hand, the gold price depreciated by 0.05% to $1669.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (YoY) (Sep) | 10.0% | 10.0% | – |

| 20:30 | USD – Core CPI (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | USD – CPI (MoM) (Sep) | 8.3% | 8.1% | – |

| 20:30 | USD – Initial Jobless Claims | 219K | 225K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -1.356M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9740, 0.9915

Support level: 0.9550, 0.9460

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6515

Support level: 0.6185, 0.5985

NZDUSD, Weekly: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 0.5925, 0.6170

Support level: 0.5605, 0.5315

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 89.20, 93.10

Support level: 86.35, 81.95

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85