210922 Morning Session Analysis

21 September 2022 Morning Session Analysis

The Dollar’s bull run continues.

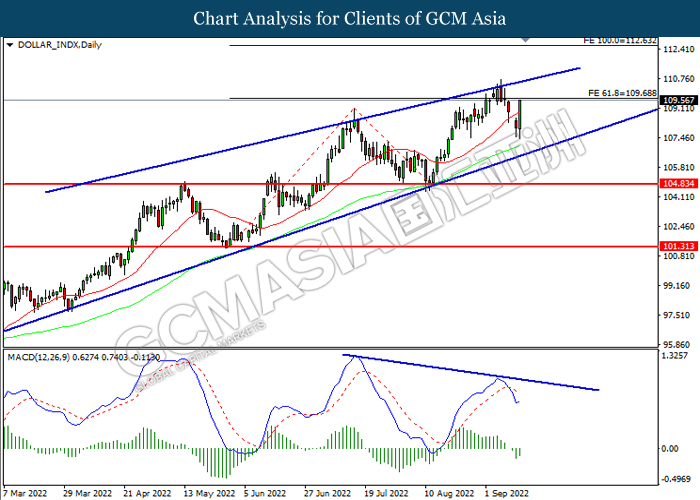

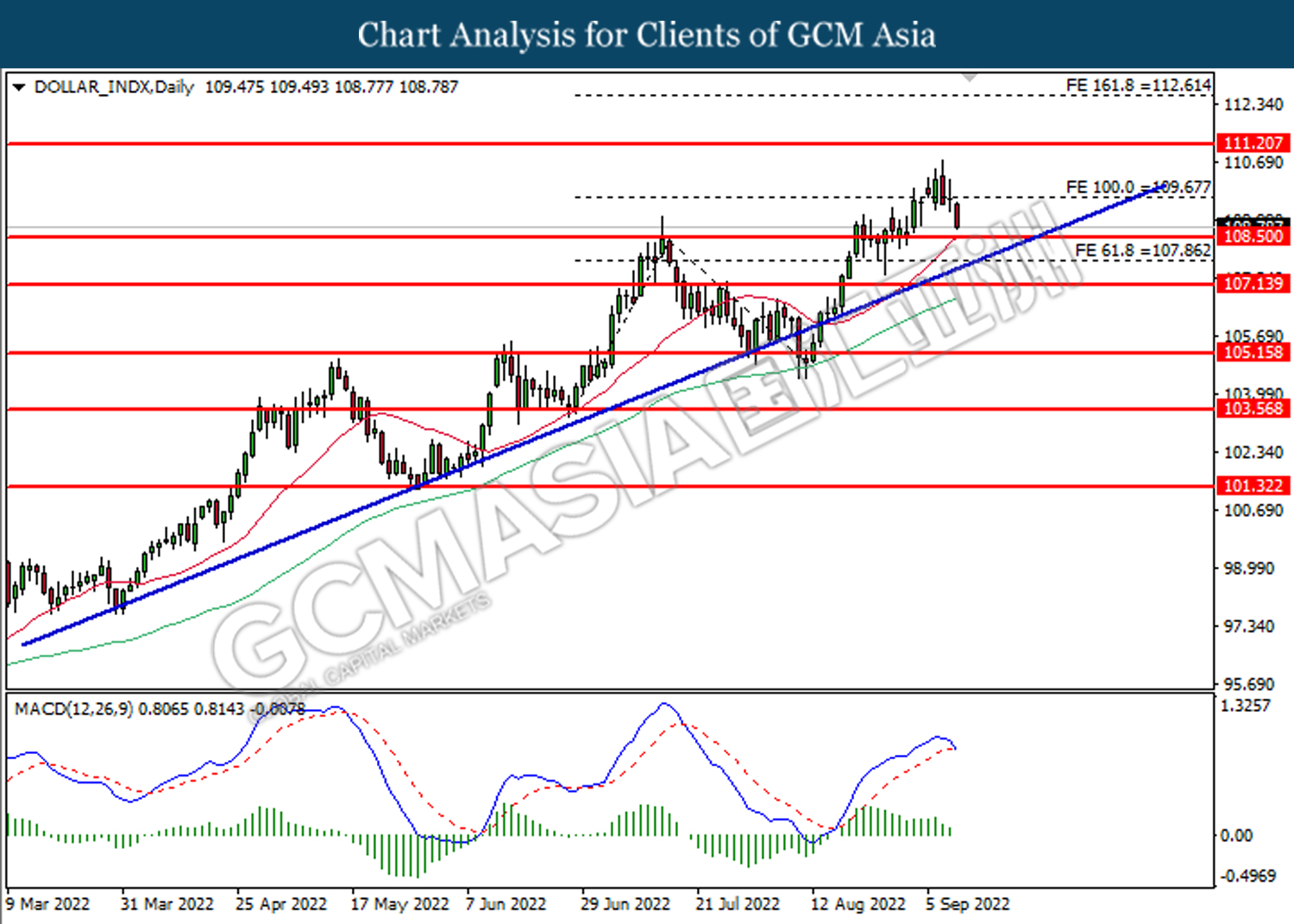

The dollar index, which gauges its value against a basket of six major currencies, regained its ground while extending the gains toward a higher level over the trading session as the hefty rate hike is not expected to come to an end at any time soon. According to the recent development, investors reckon that the US central bank will raise its cash rate by three-quarters of a basis percentage point at the end of the two-day policy meeting. Prior to now, the Federal Reserve has increased the interest rate from January’s 0.25% to 2.50% in the face of stubborn inflation. Talking about inflation, the CPI data used to represent the inflationary pressure of a nation has started to decline over the last two months in the US. However, the current inflation figure is still far above the 2% long-term target of the Fed, which was the main attributor to urging the central bank to continue with the aggressive tightening path. According to the FedWatch Tool, the target rate probability for a 75-basis point rate hike in the 22 Sep 2022 Fed Meeting was 83.0%, while the probability of a 1 per cent rate hike was 17%. As of writing, the dollar index surged 0.42% to 110.20.

In the commodities market, the crude oil price dropped 0.92% to $83.93 per barrel as the Dollar Index jumped amid a hefty rate hike ahead. Besides, the gold prices depreciated by 0.04% to $1665.50 per troy ounce following the dollar strengthening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Economic Projections

(22nd Sep)

02:00 USD FOMC Statement

(22nd Sep)

02:00 USD FOMC Press Conference

(22nd Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Existing Home Sales (Aug) | 4.81M | 4.70M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.442M | 2.161M | – |

| 02:00

(22nd Sep) |

USD -Fed Interest Rate Decision | 2.50% | 3.25% | – |

Technical Analysis

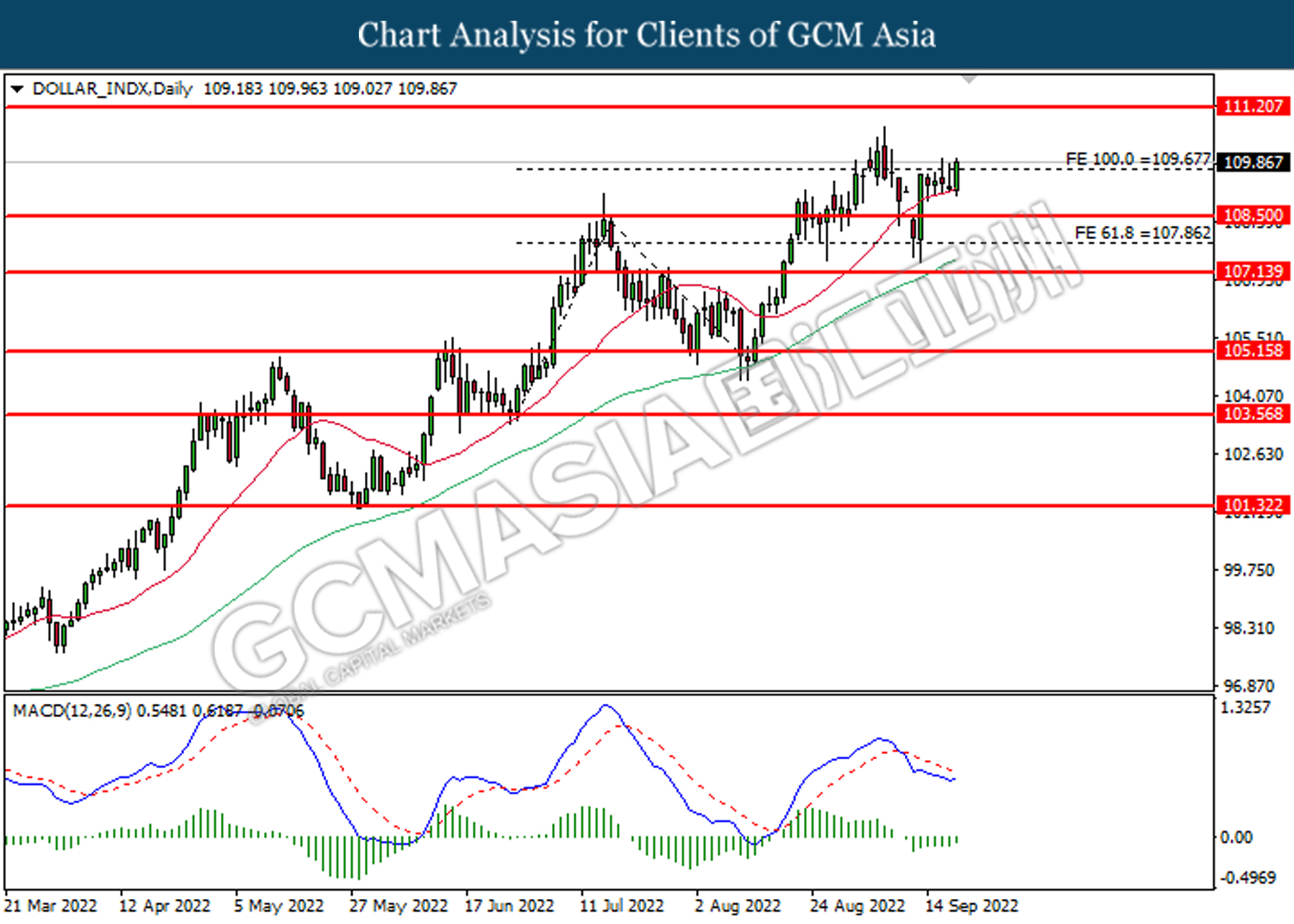

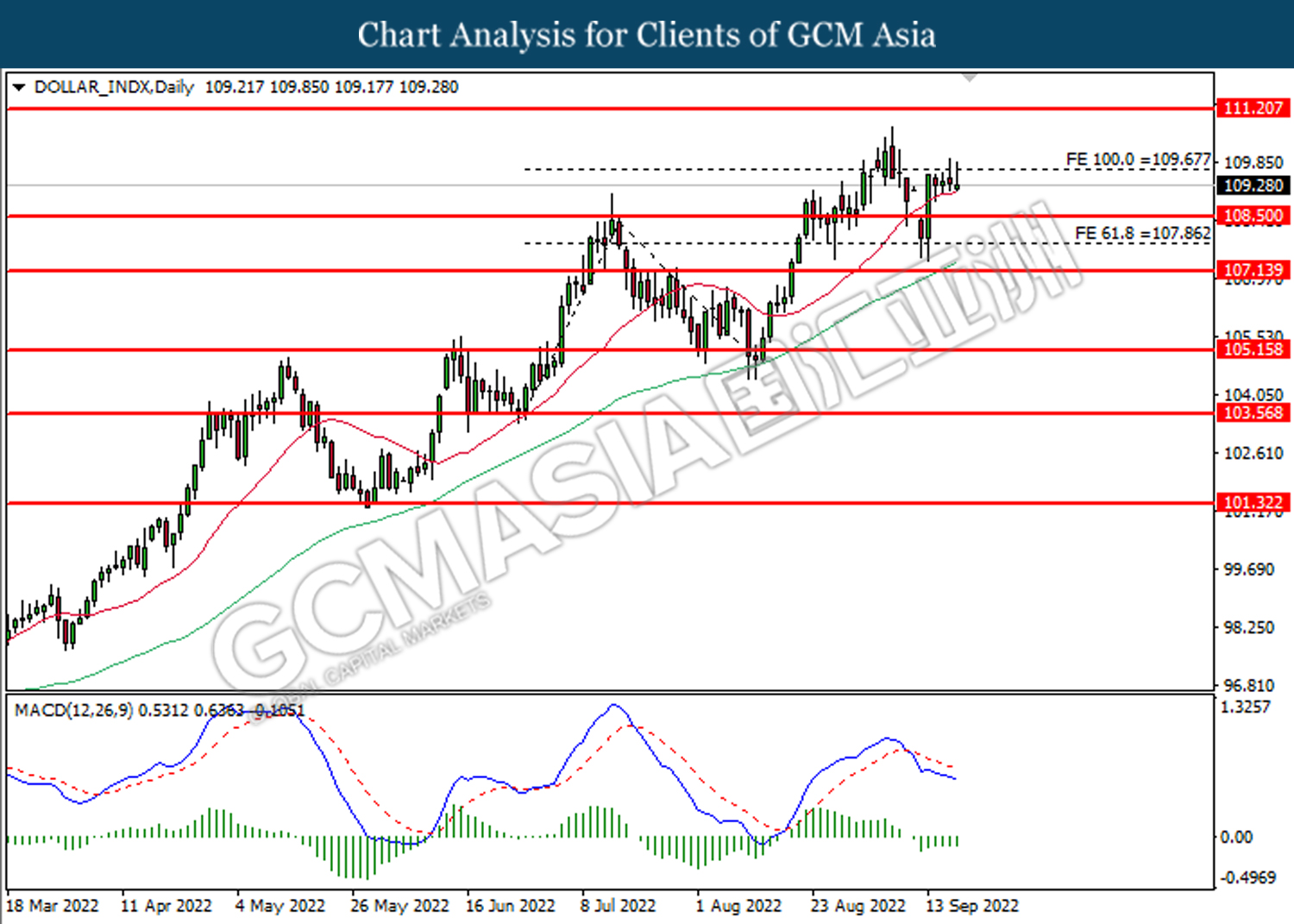

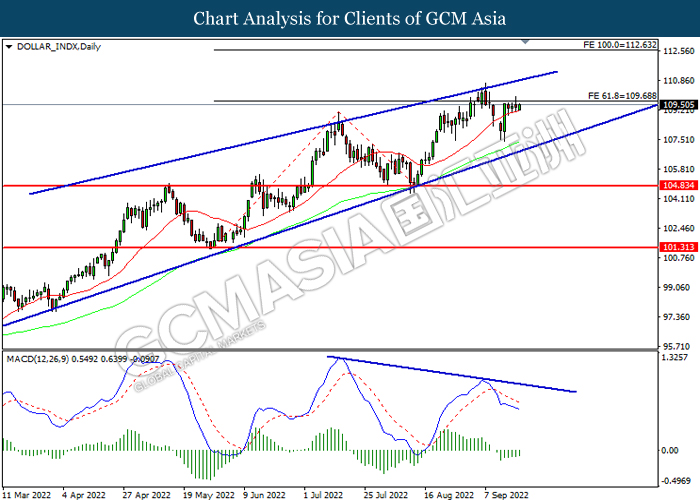

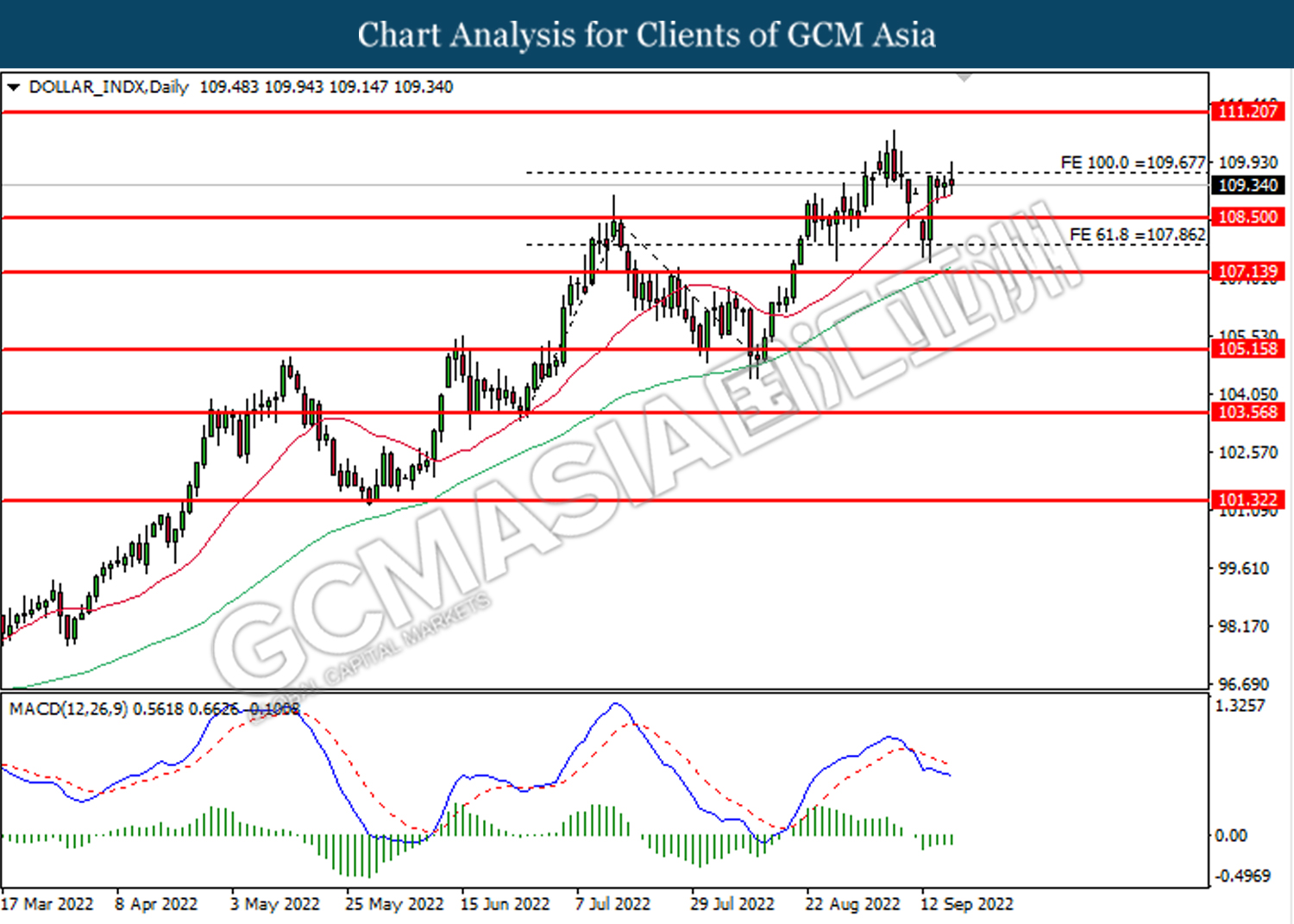

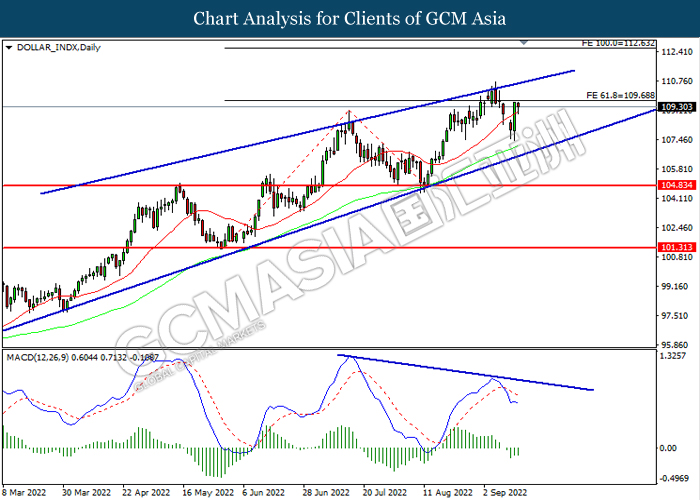

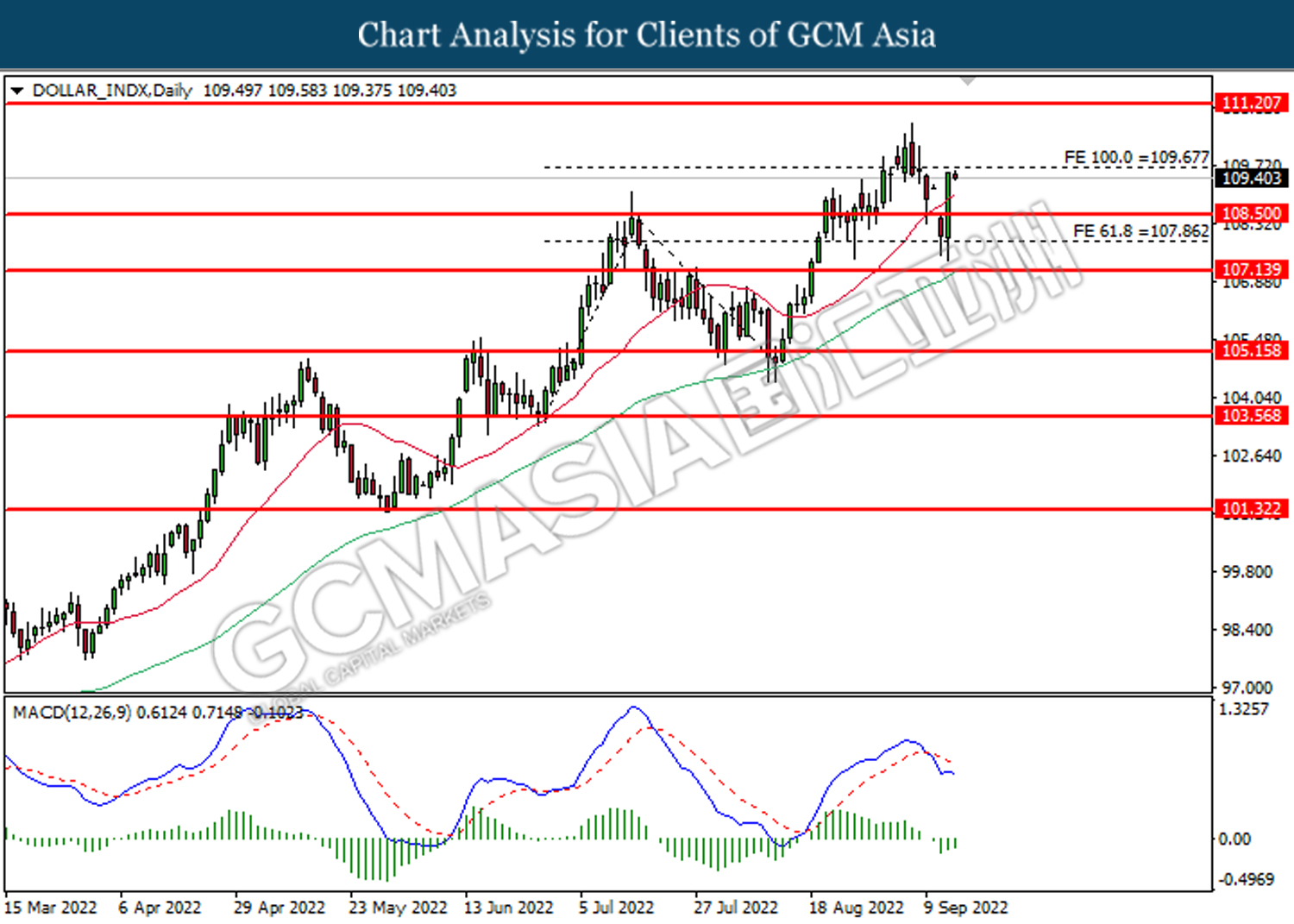

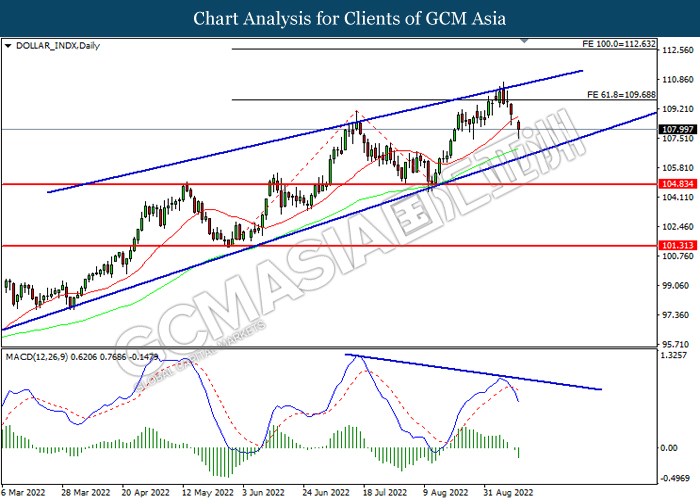

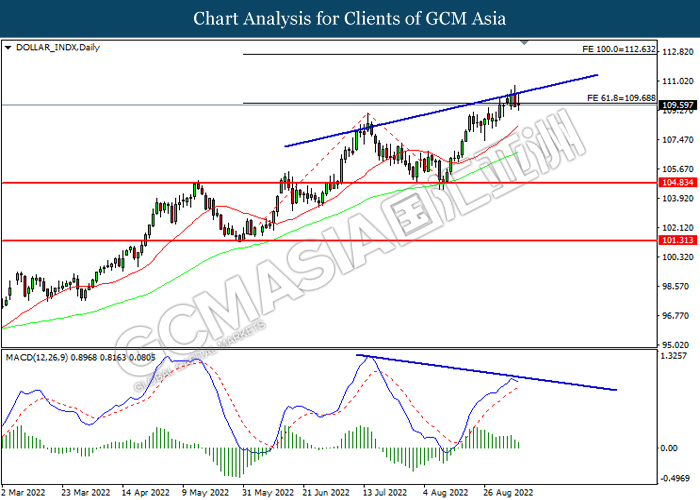

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

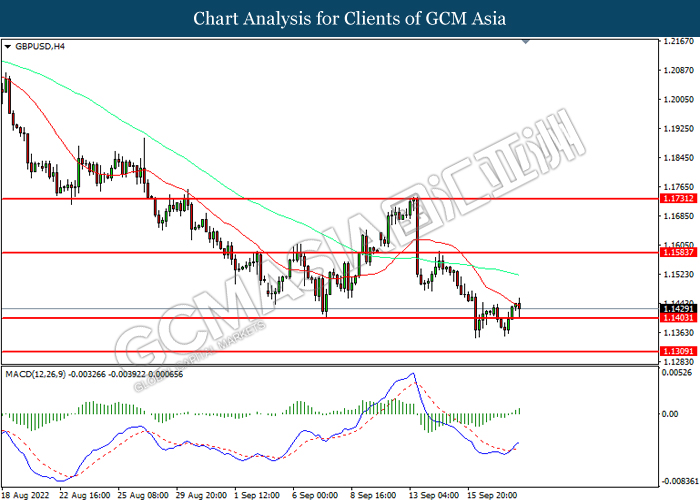

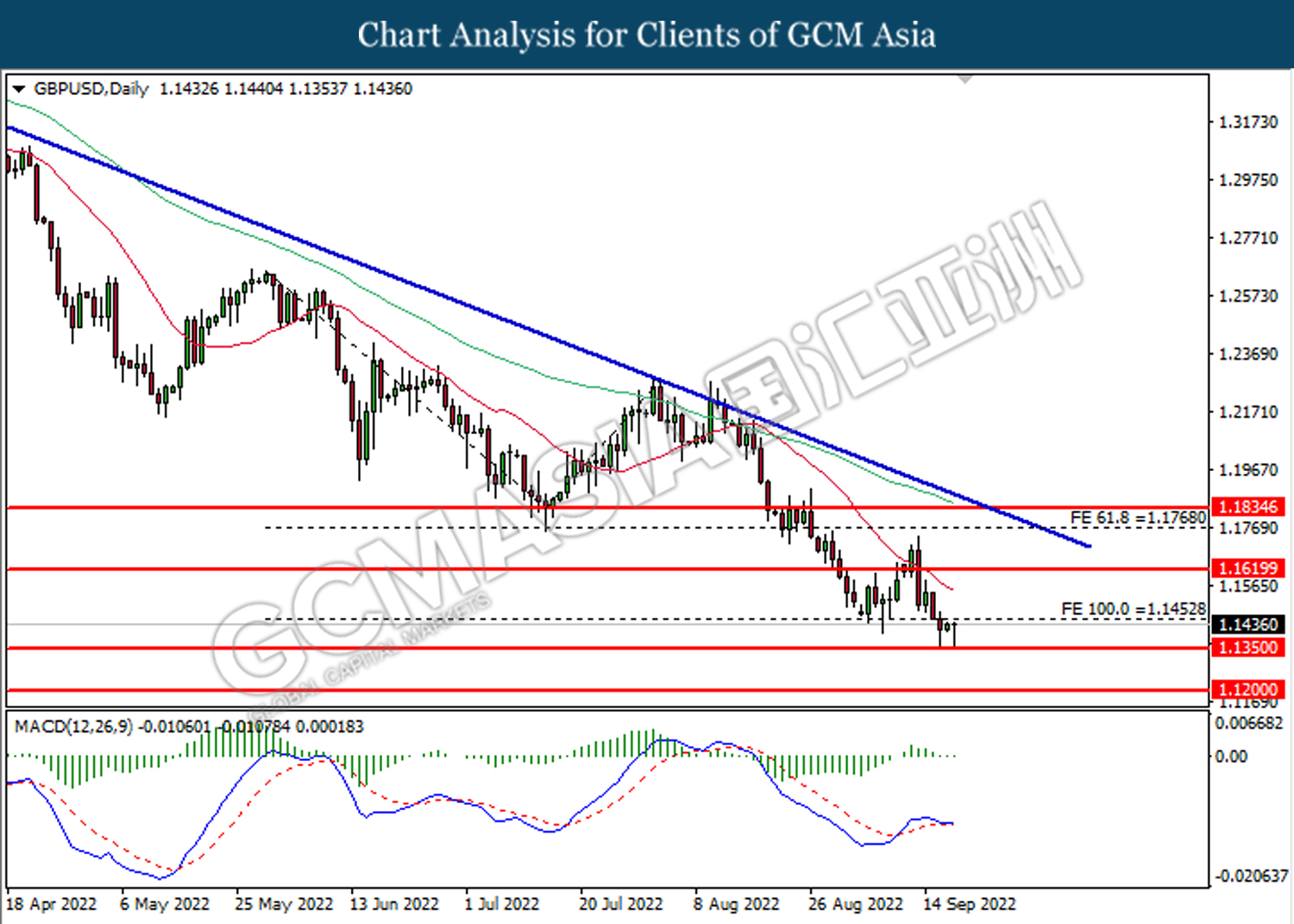

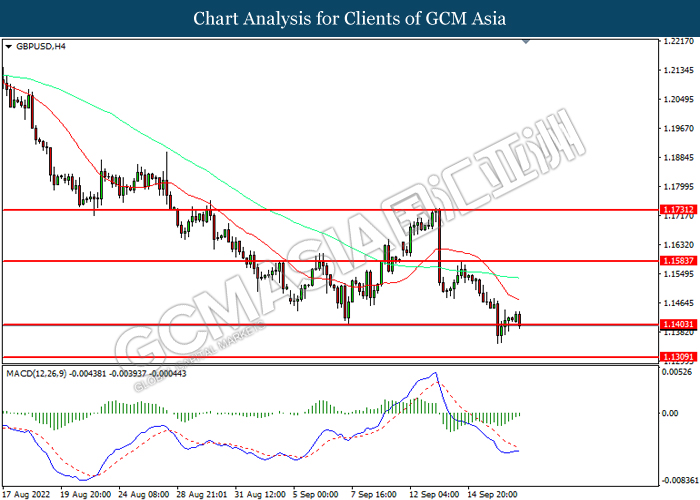

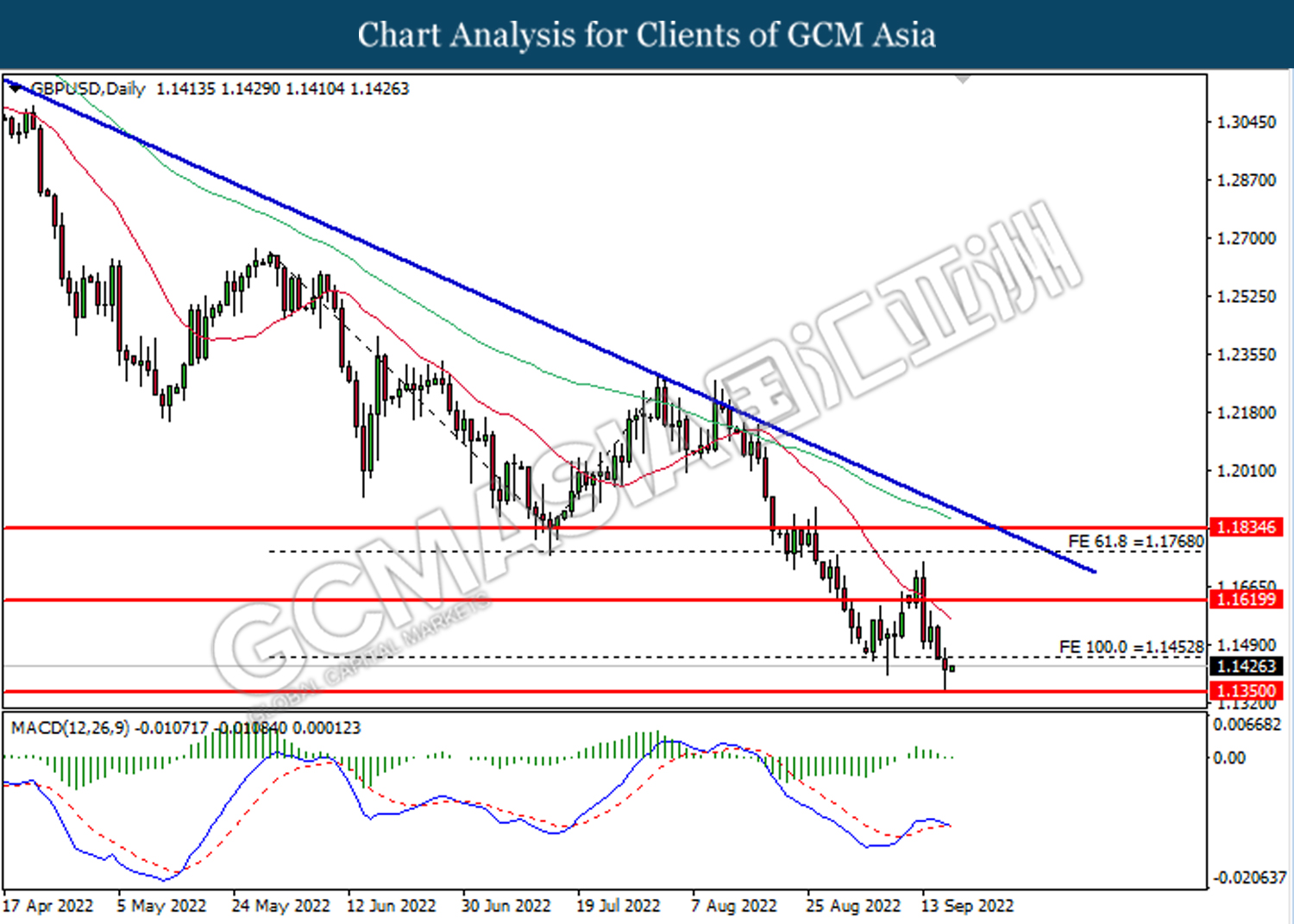

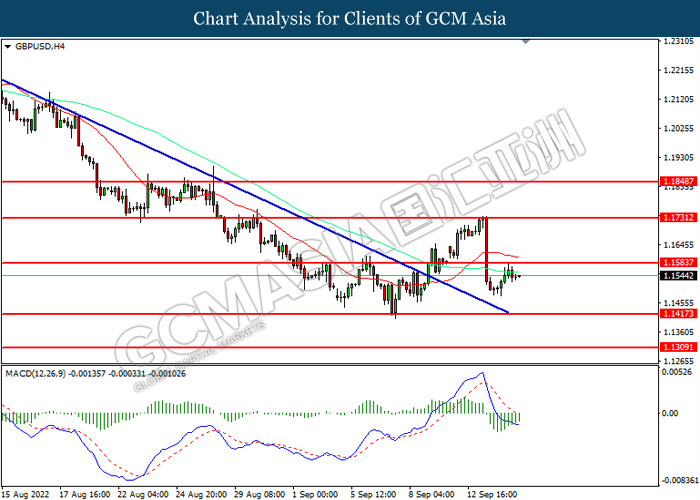

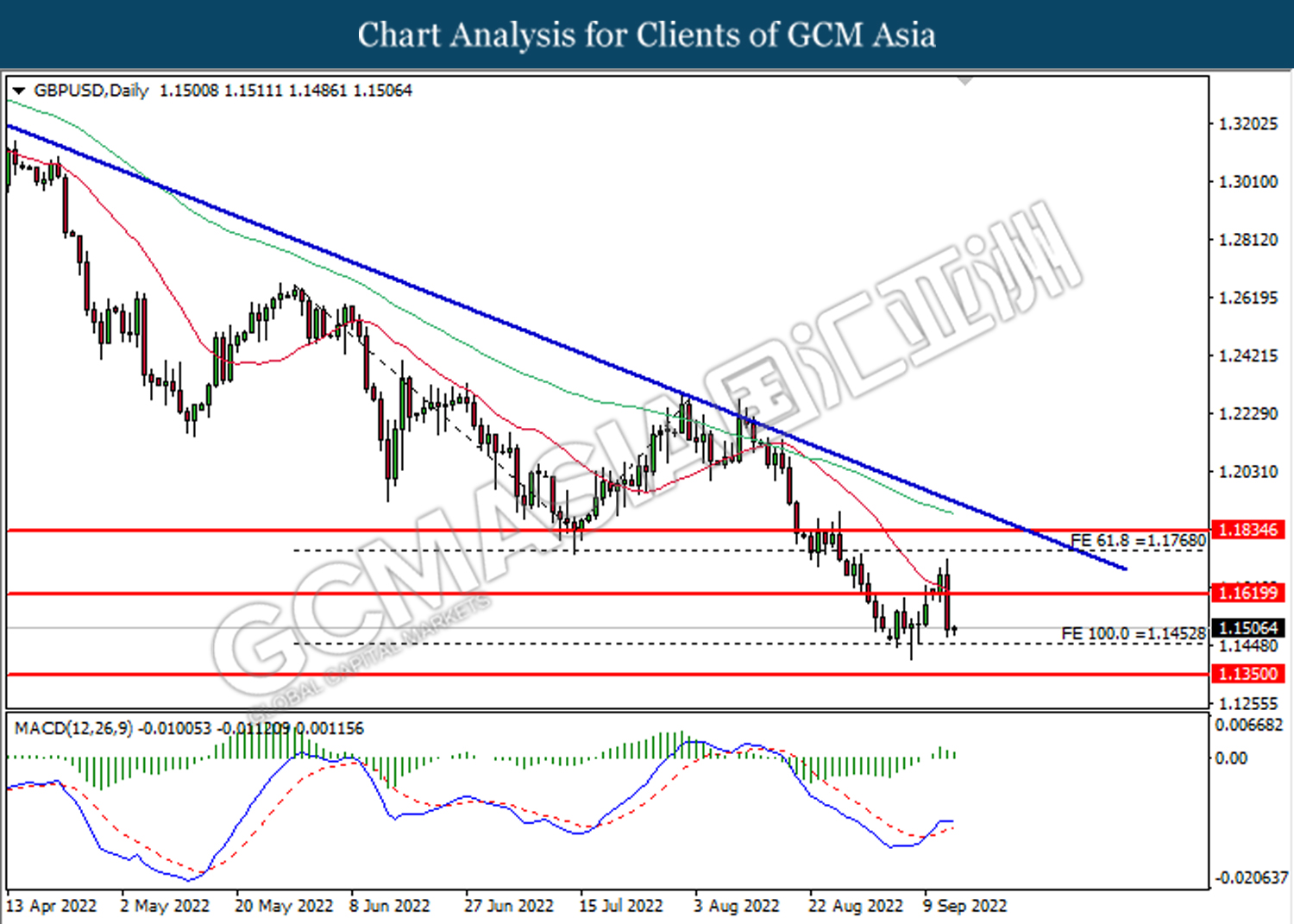

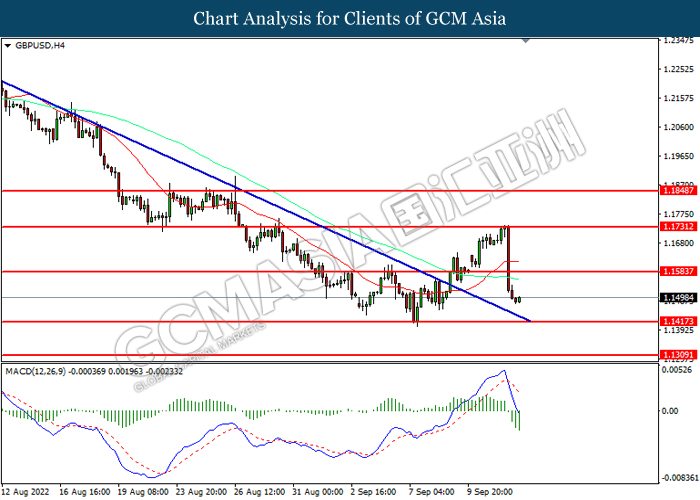

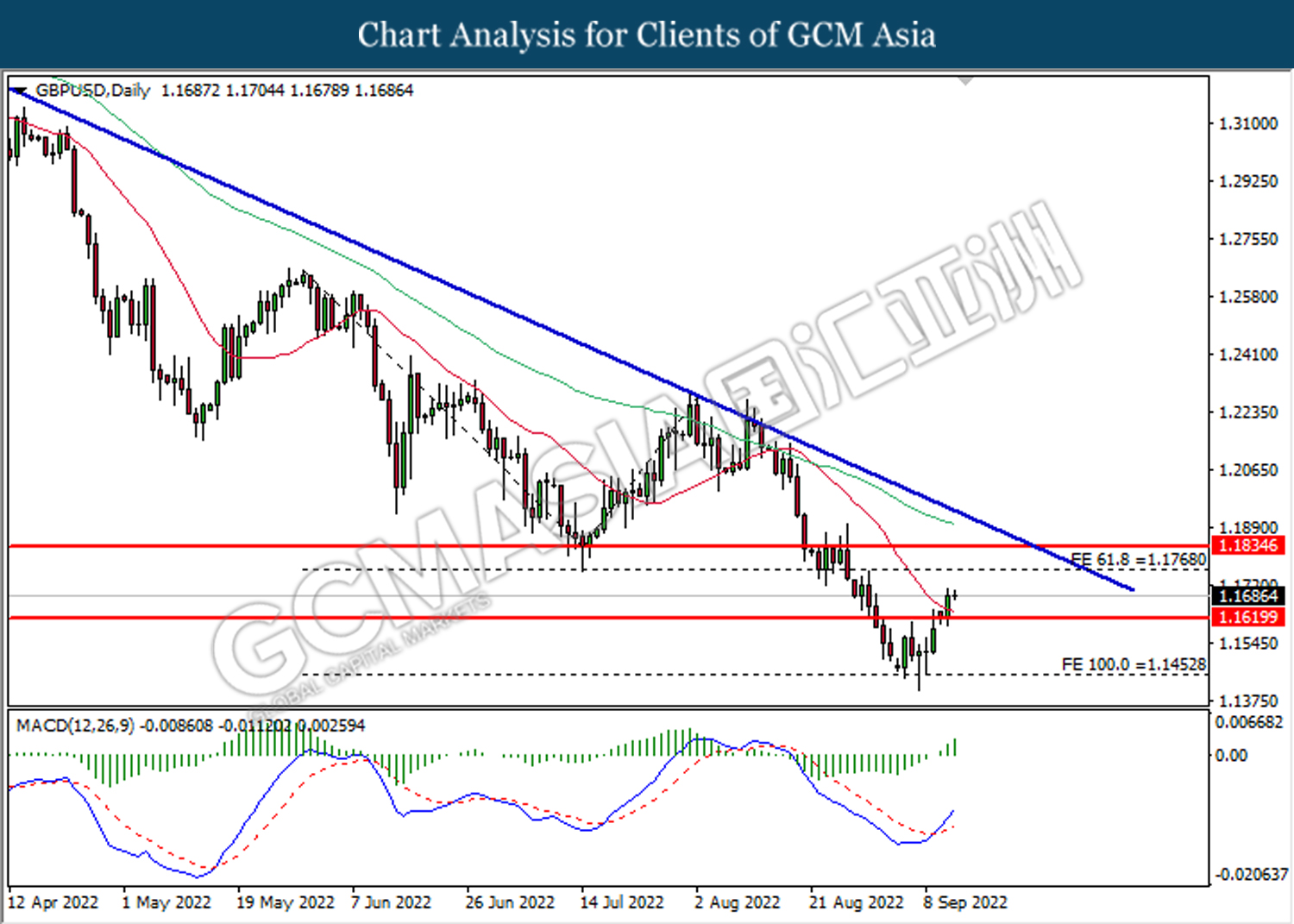

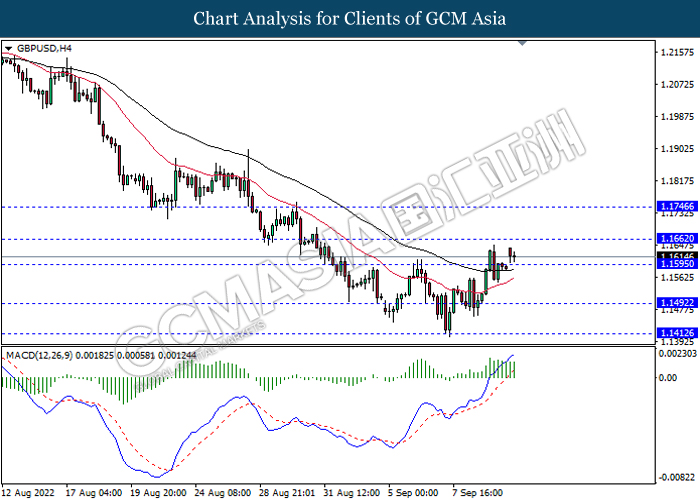

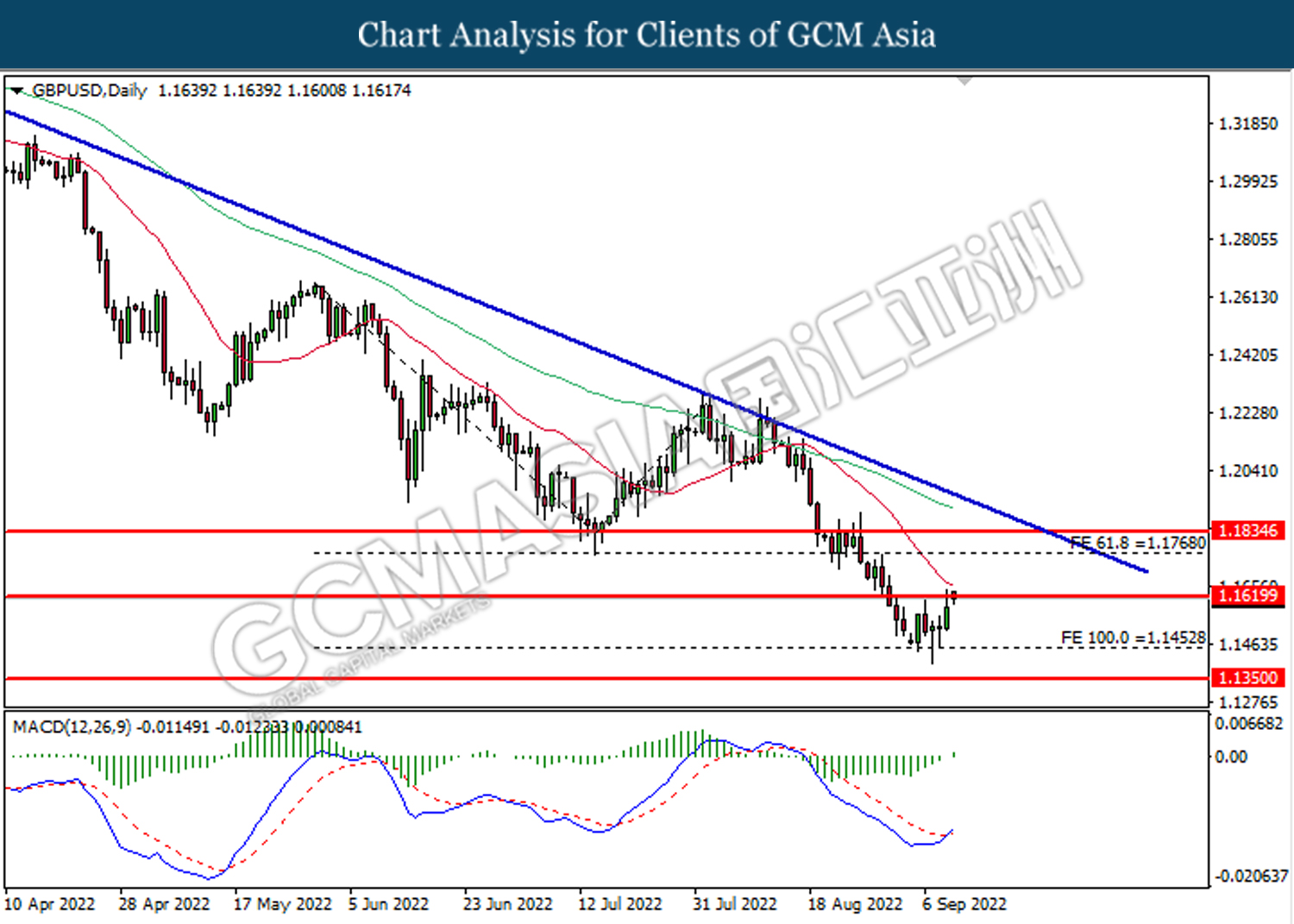

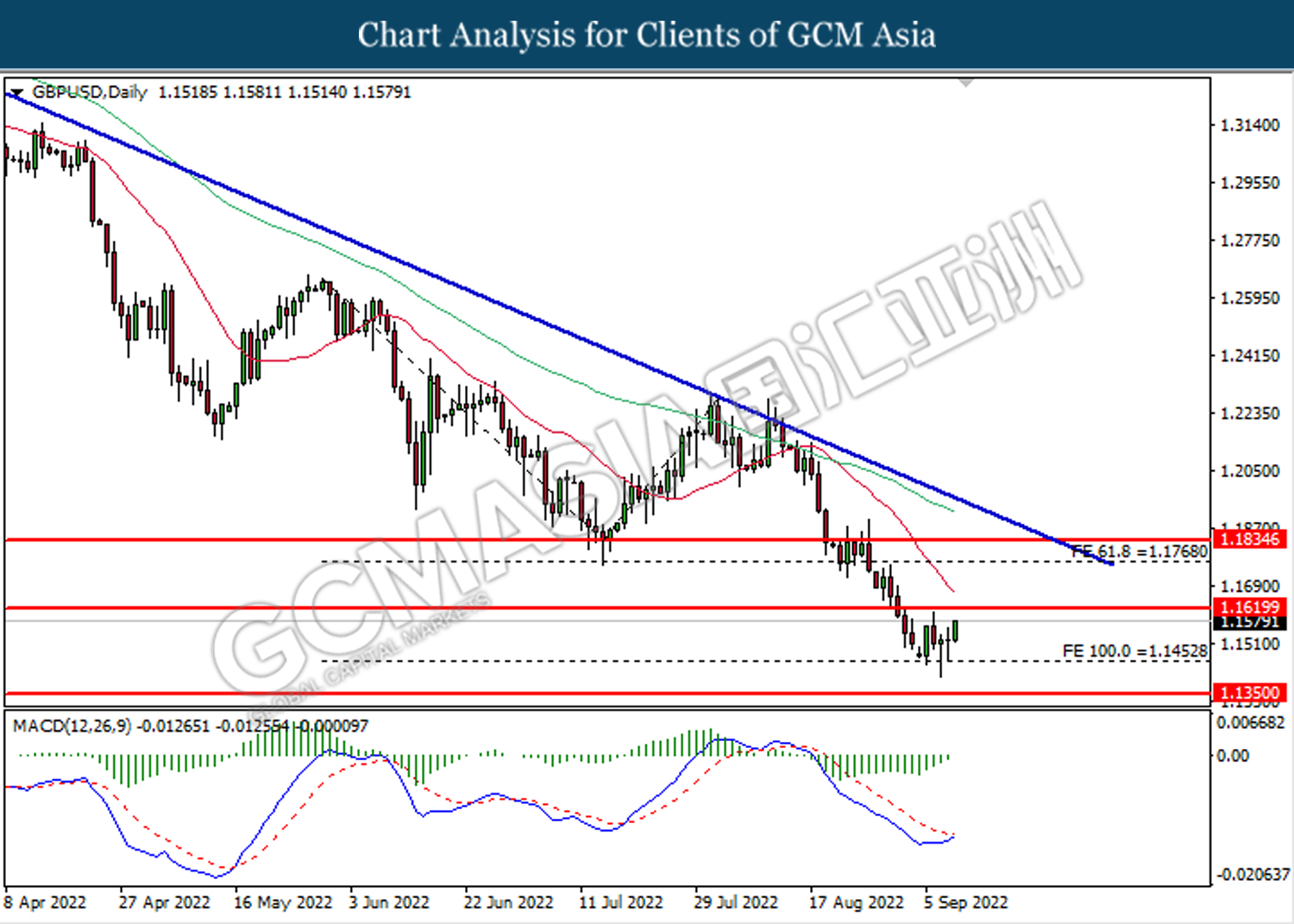

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1455. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1350.

Resistance level: 1.1455, 1.1620

Support level: 1.1350, 1.1200

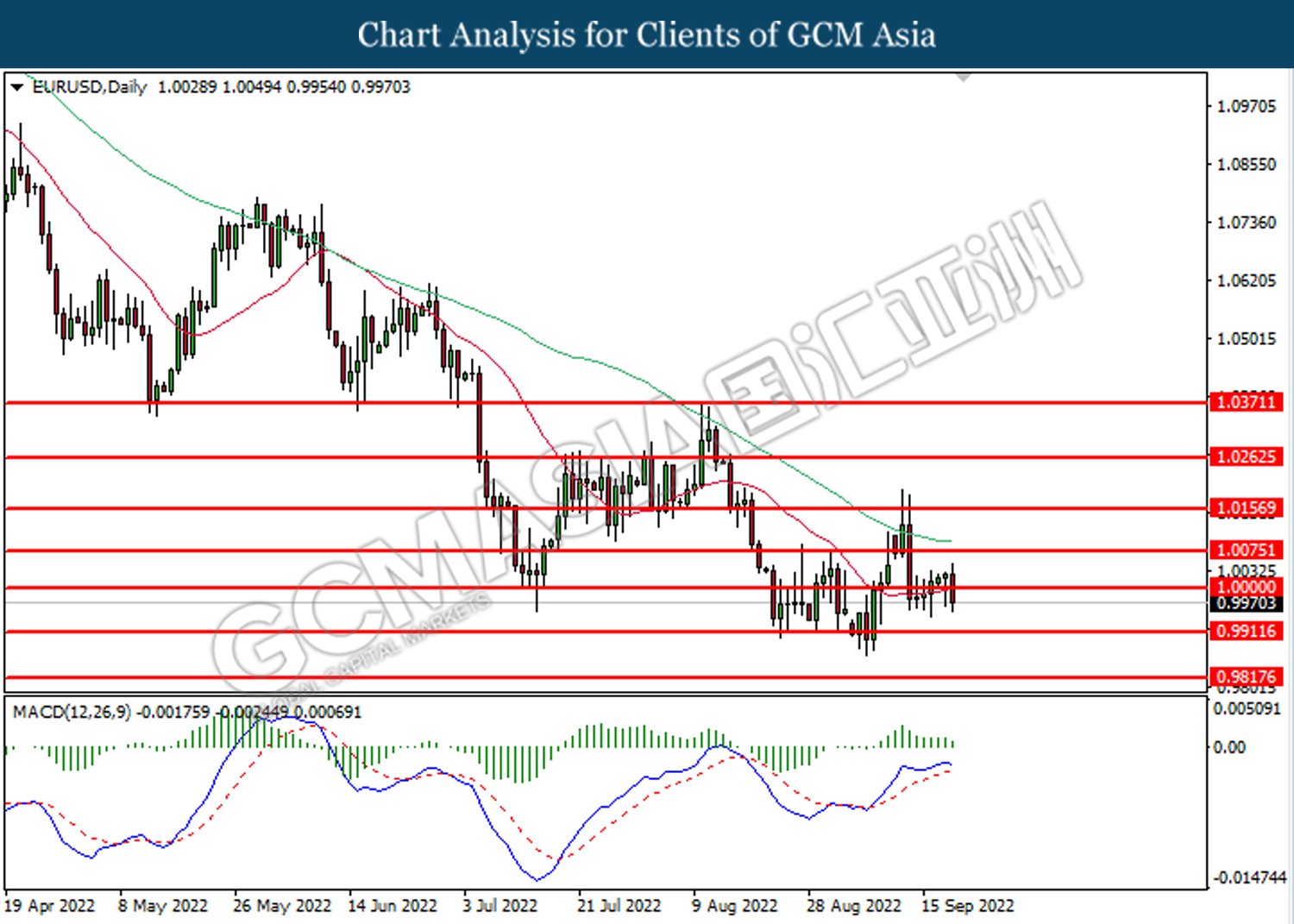

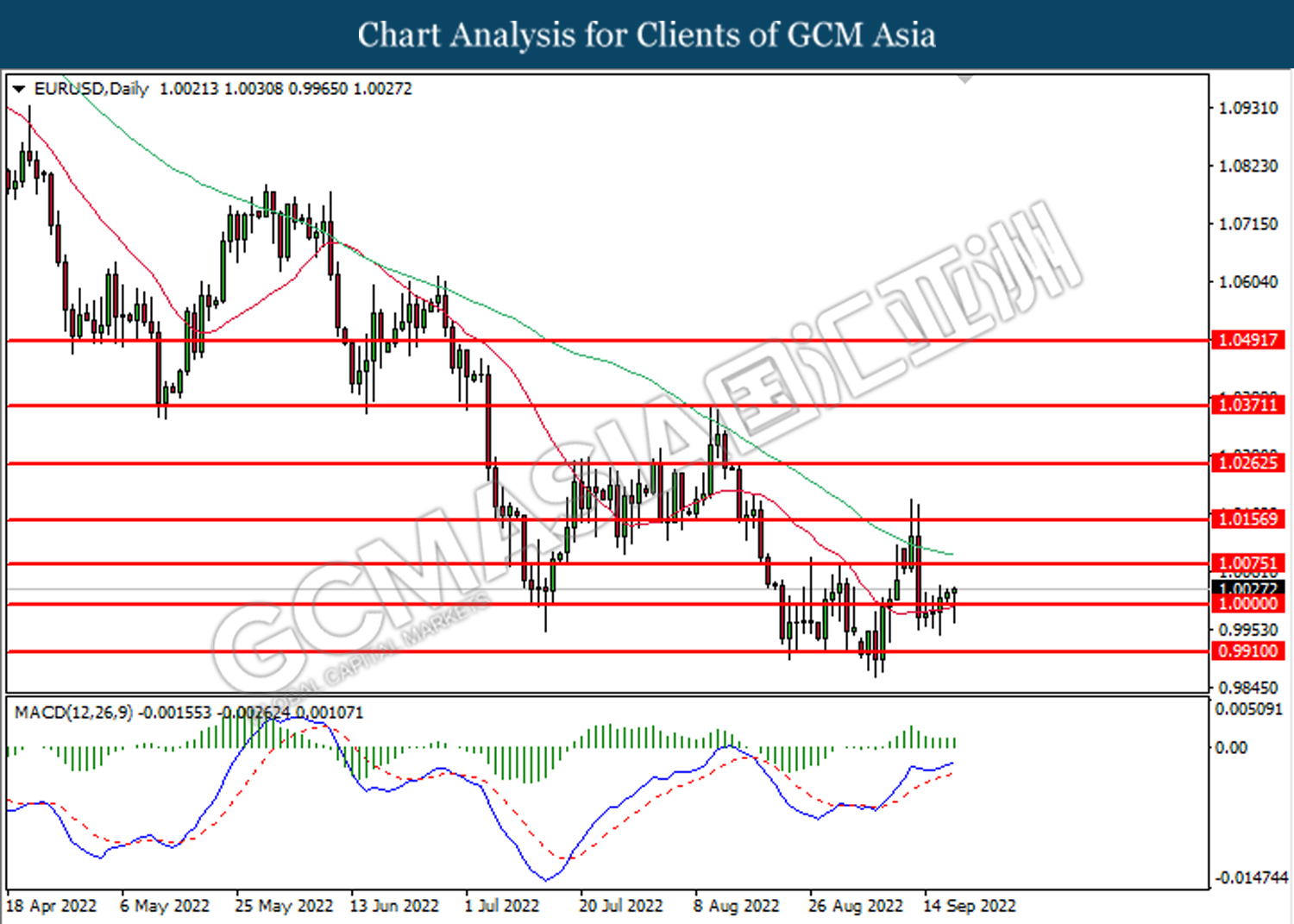

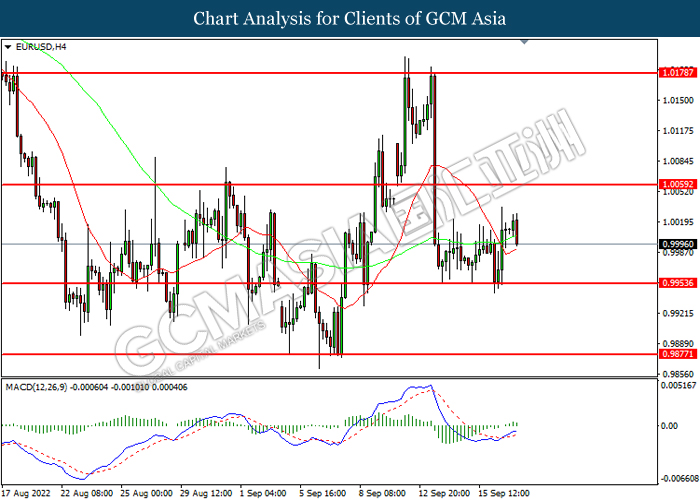

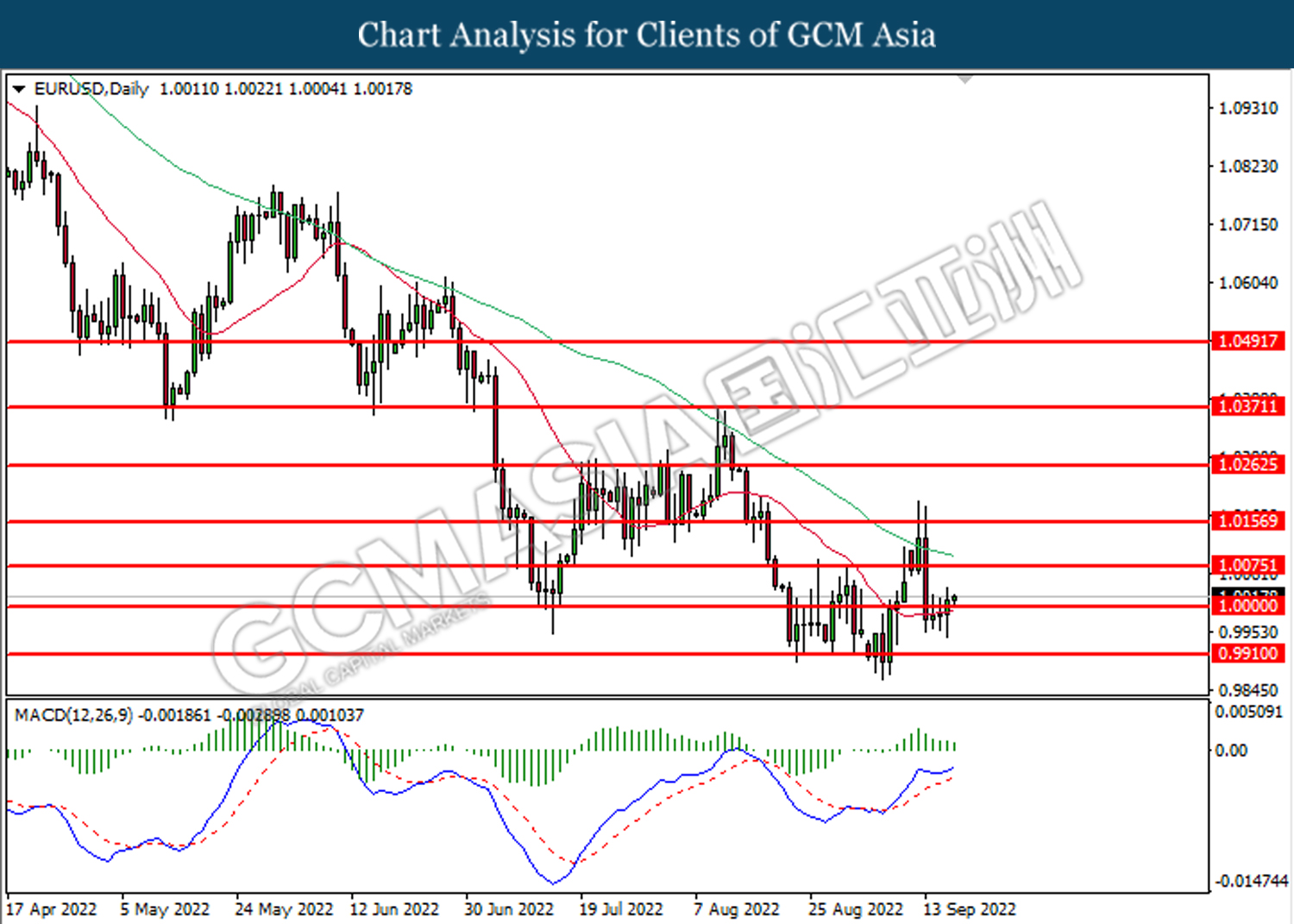

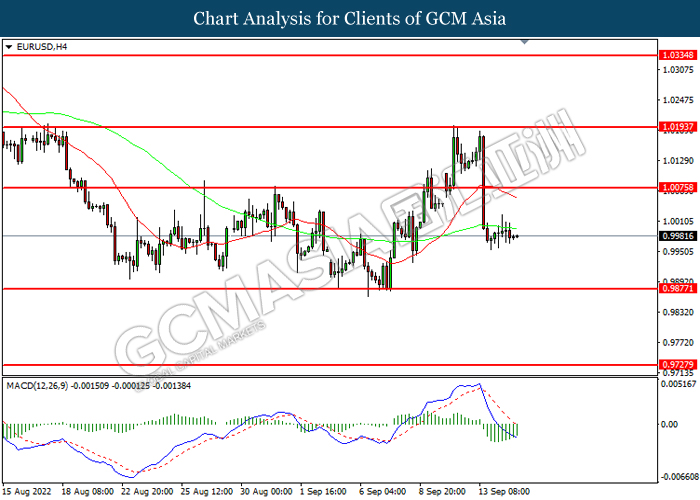

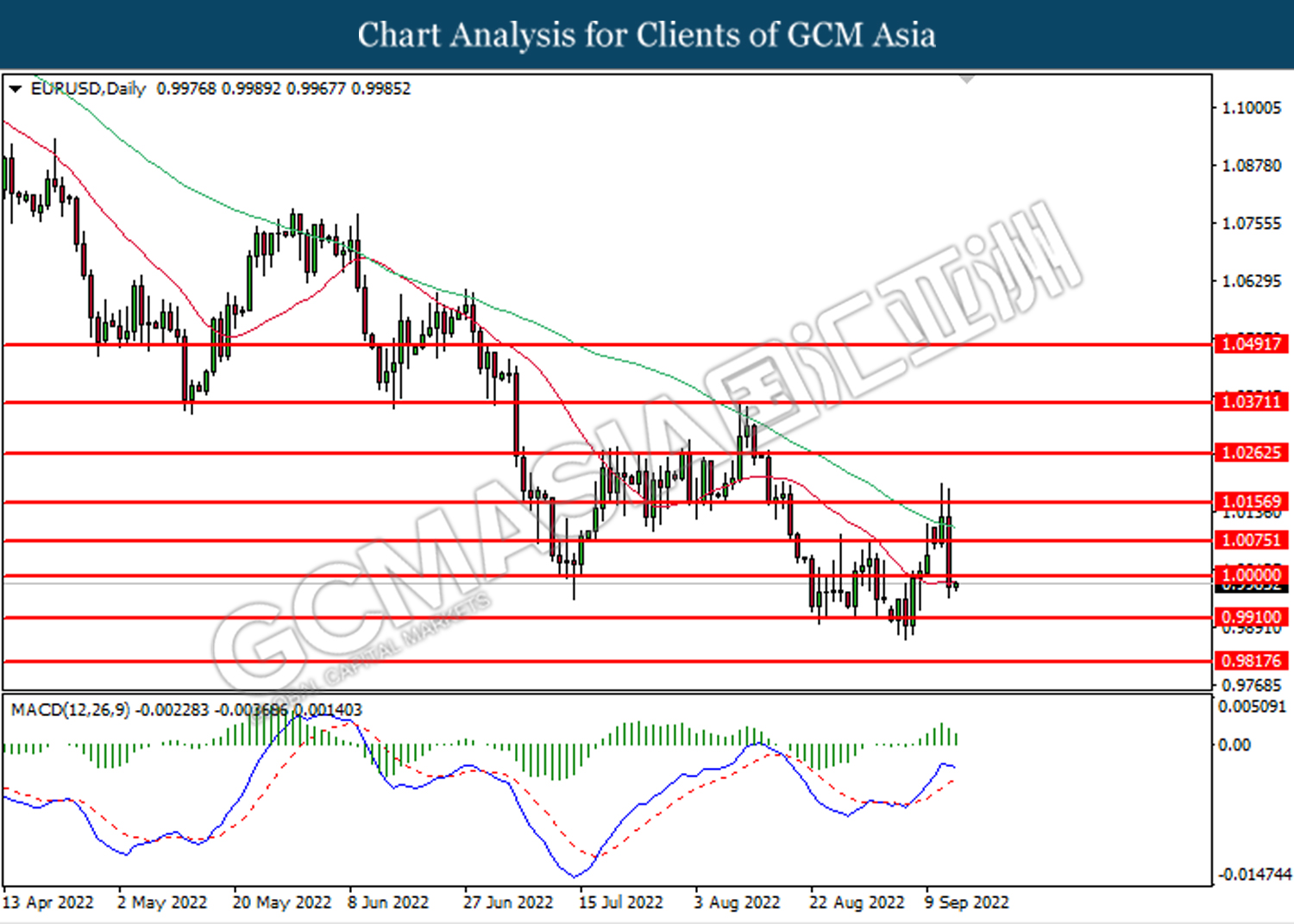

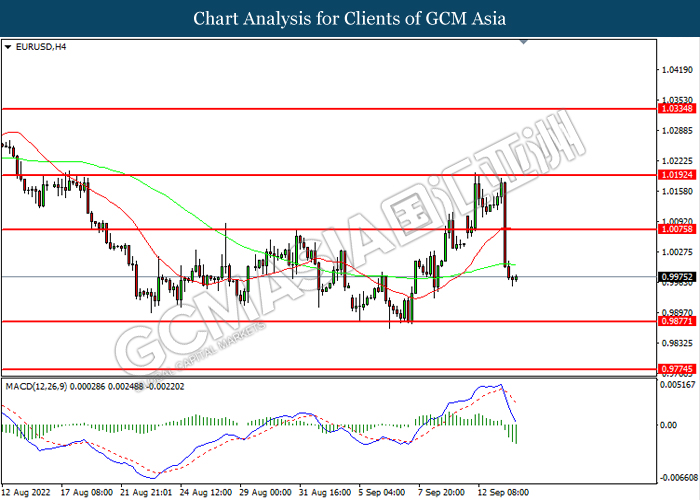

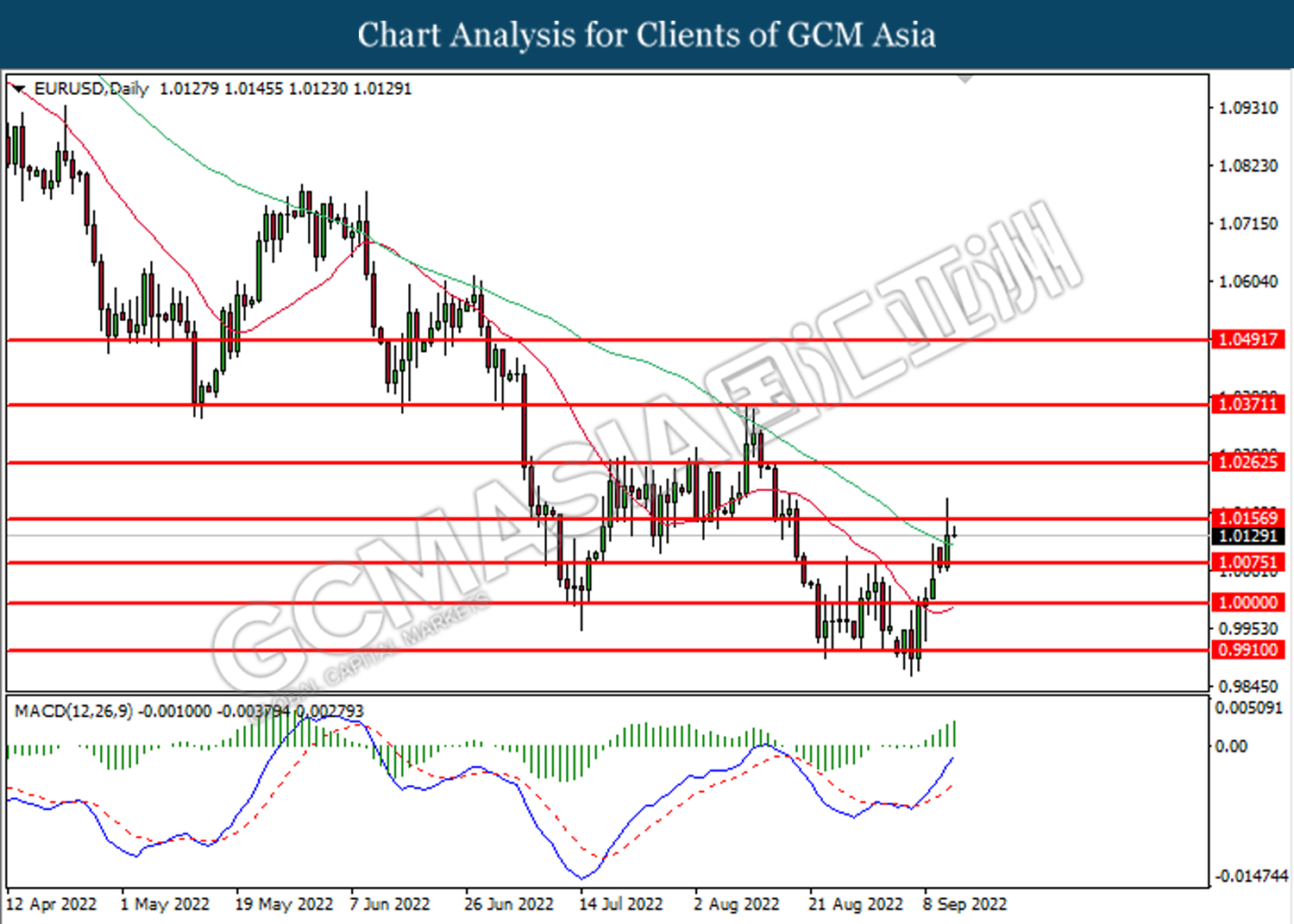

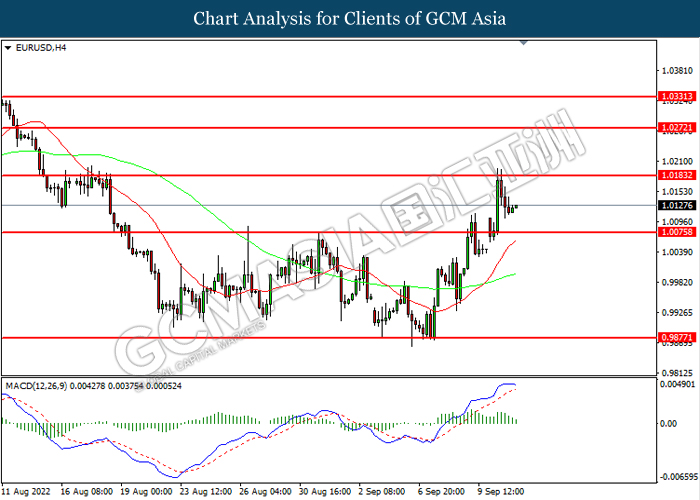

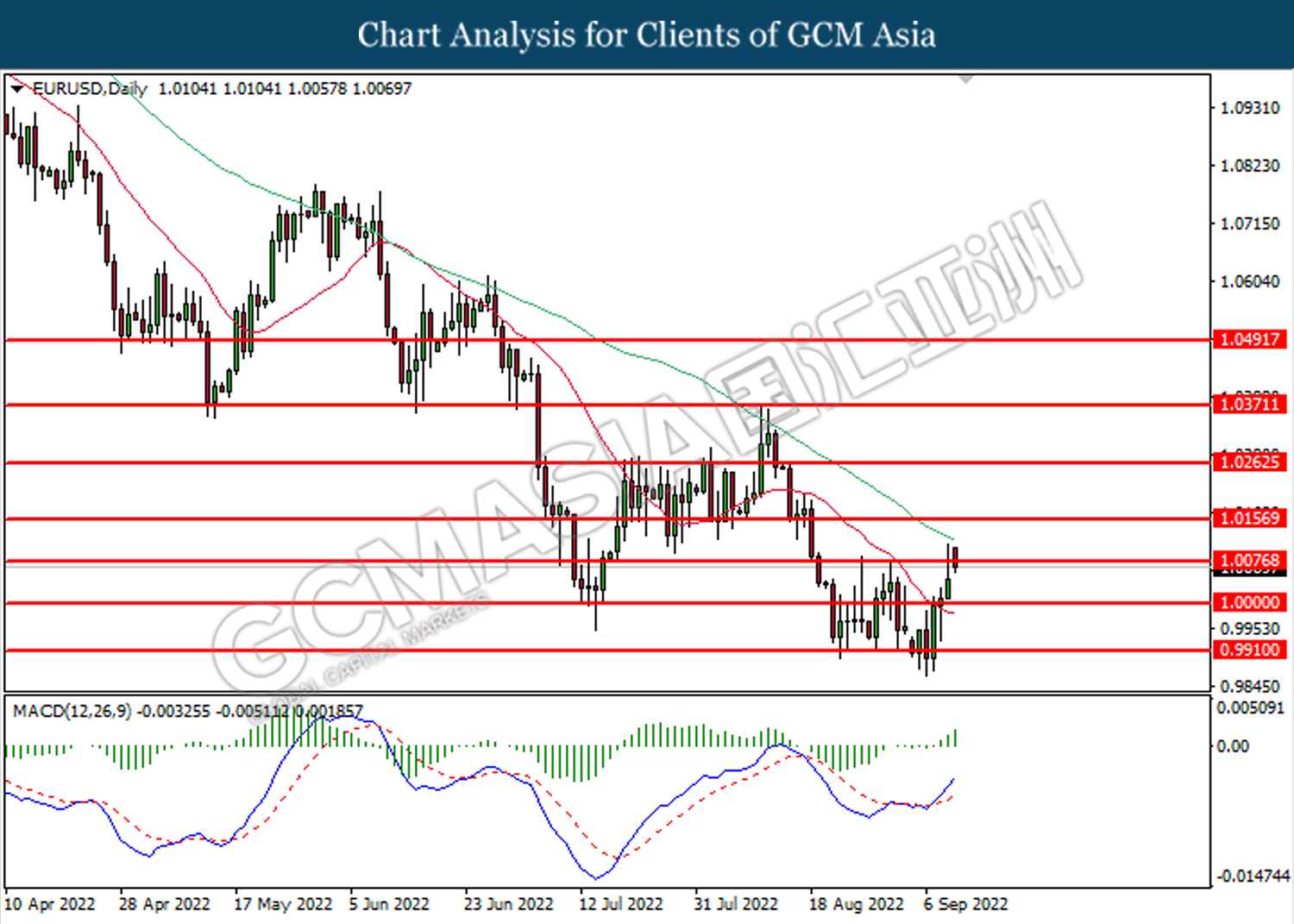

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the previous support level at 1.0000.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

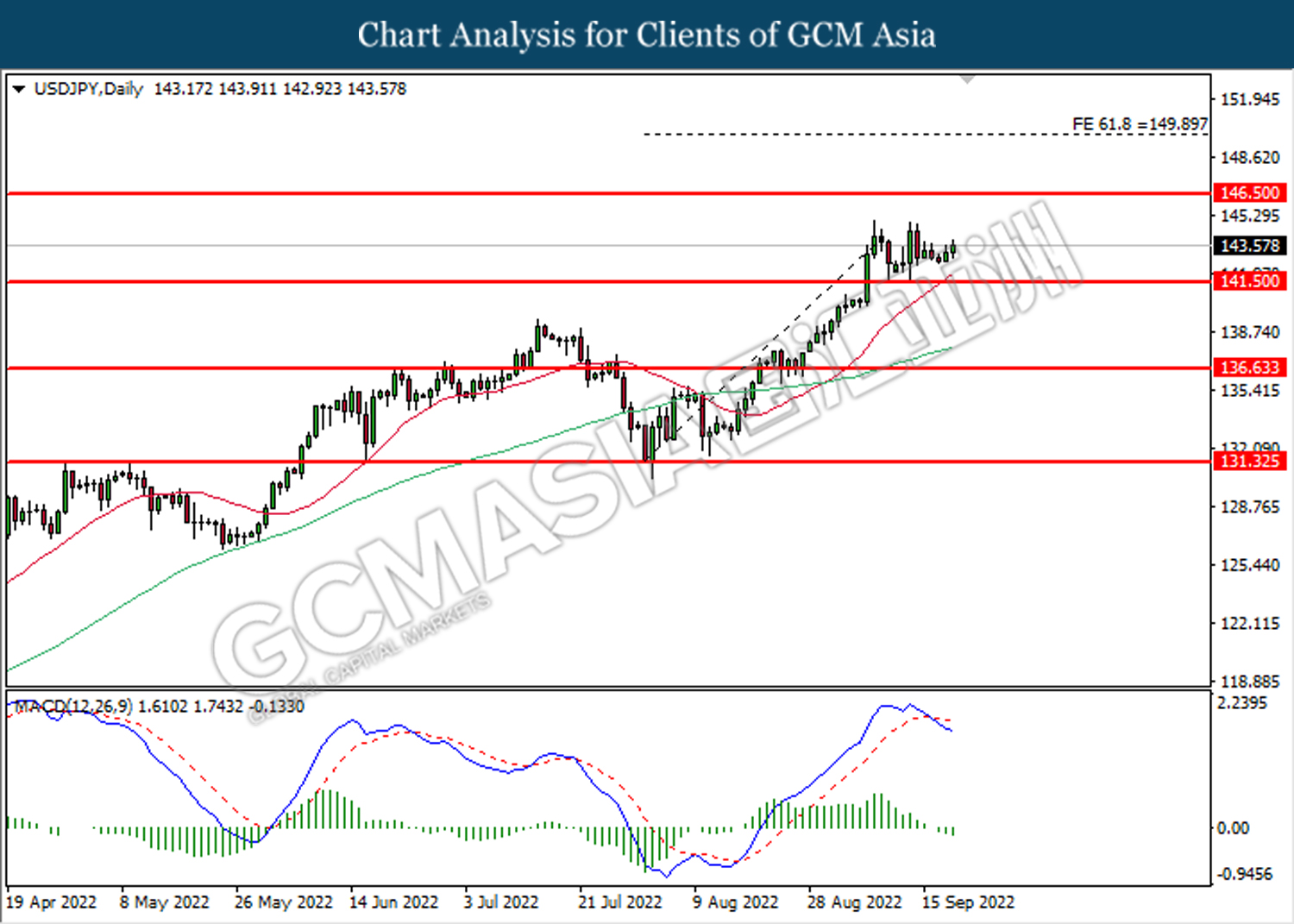

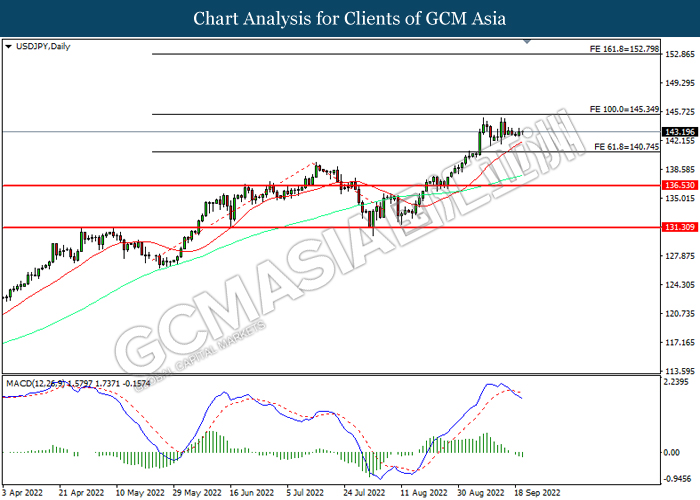

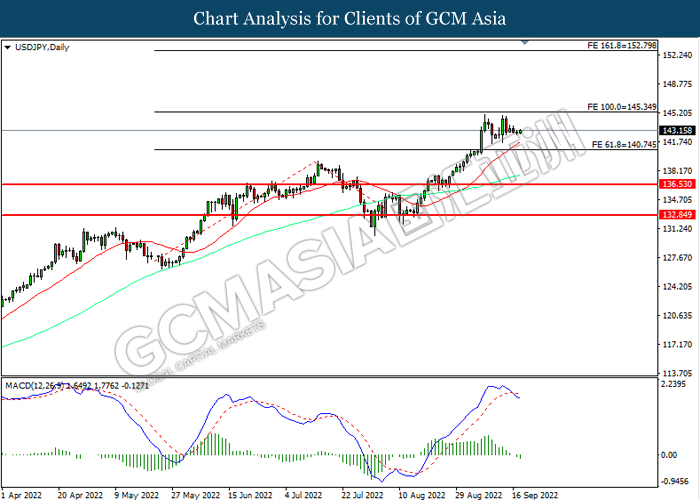

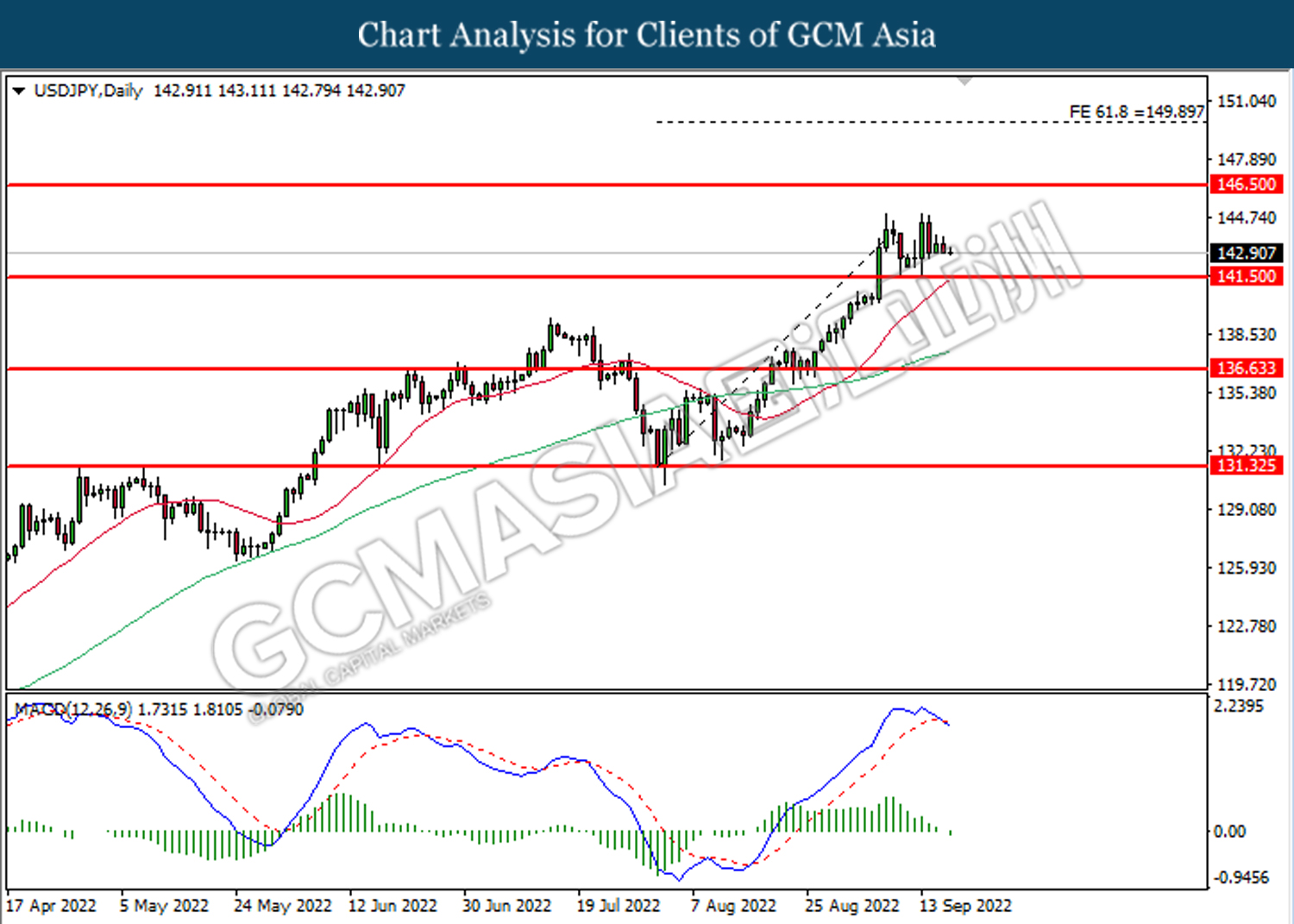

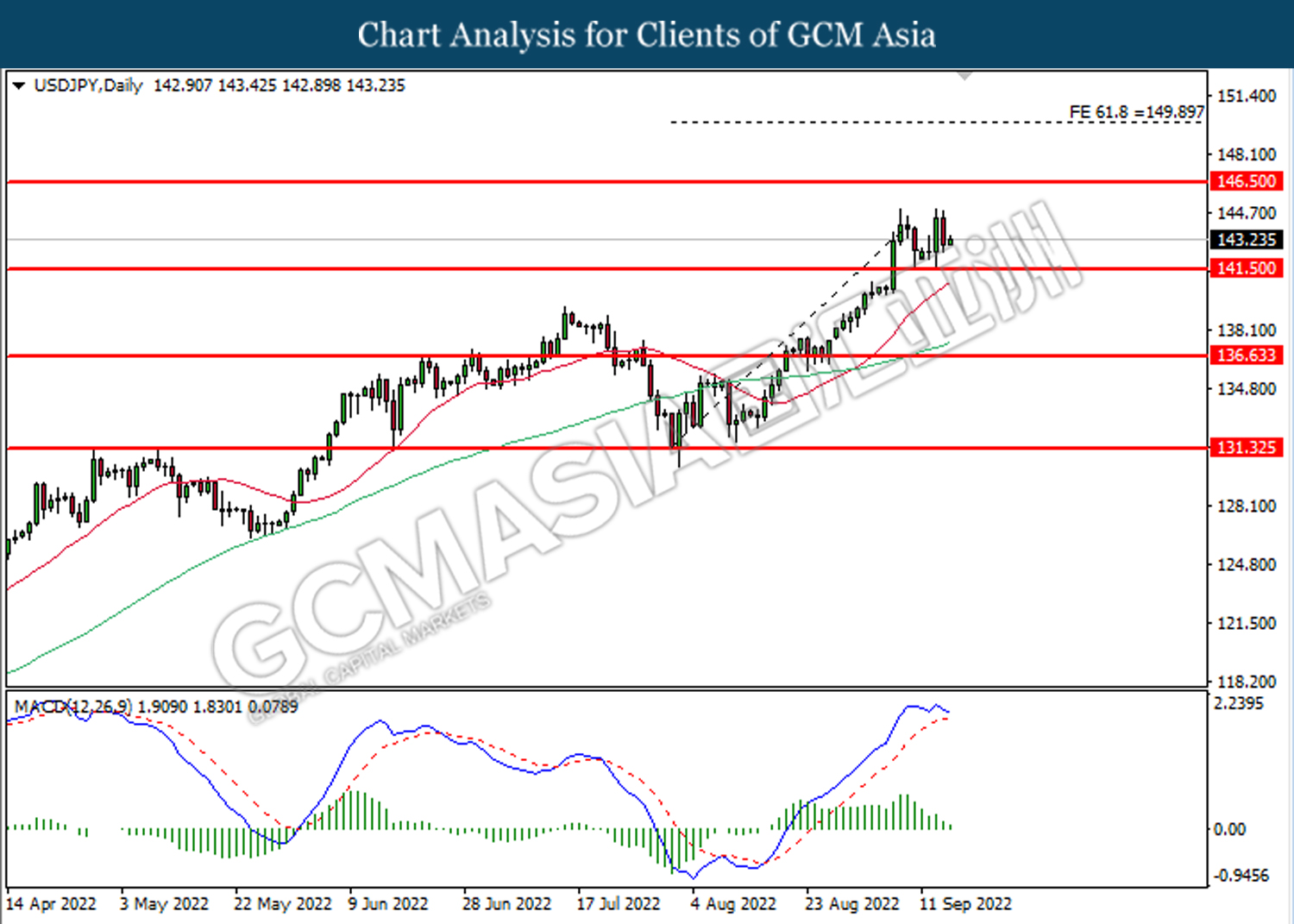

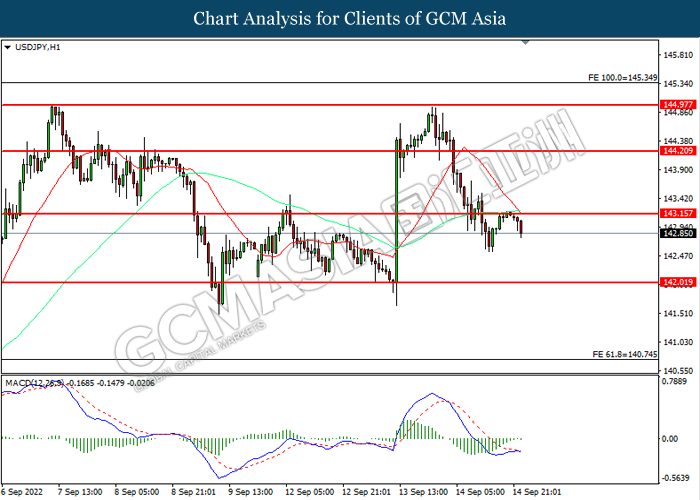

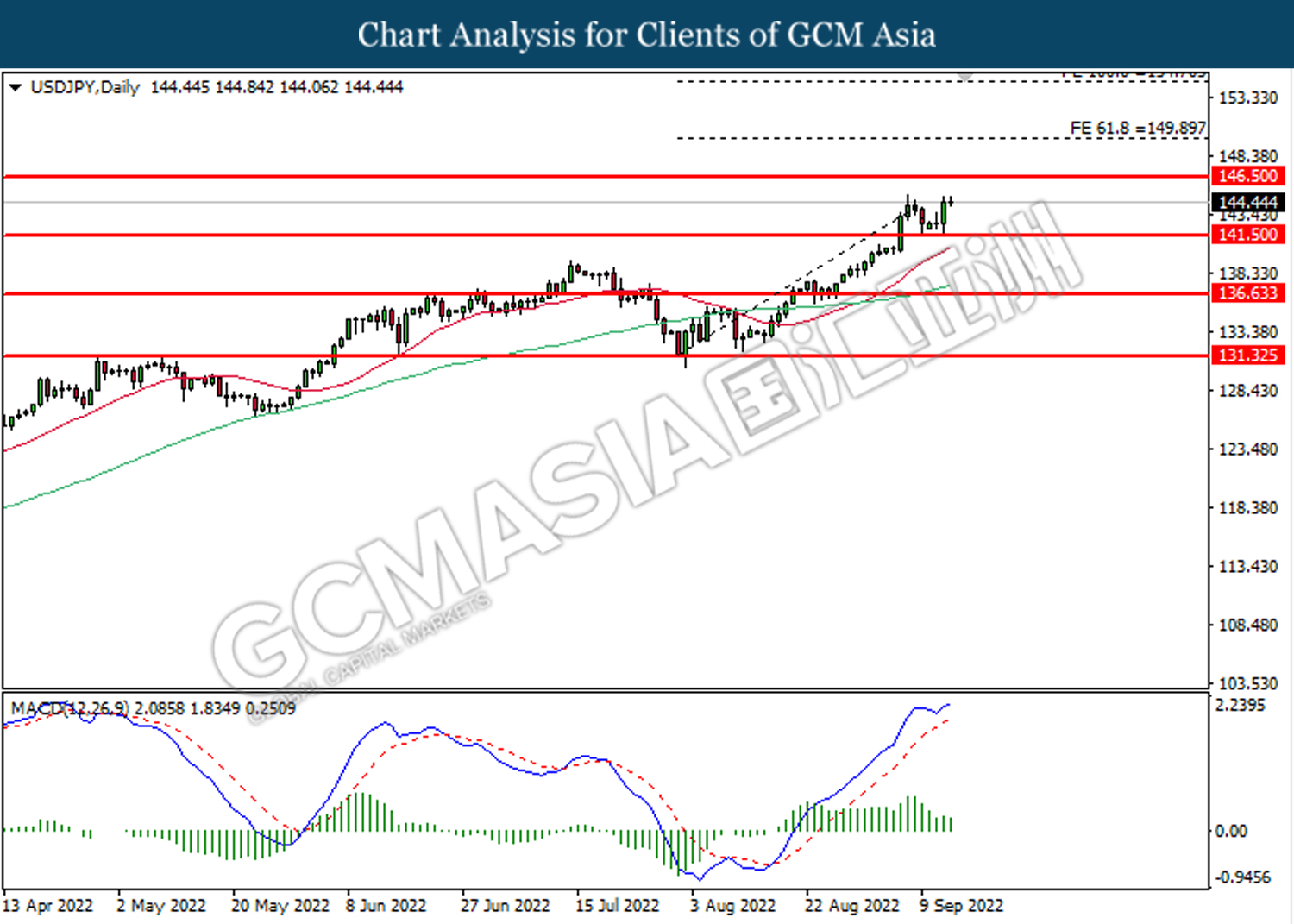

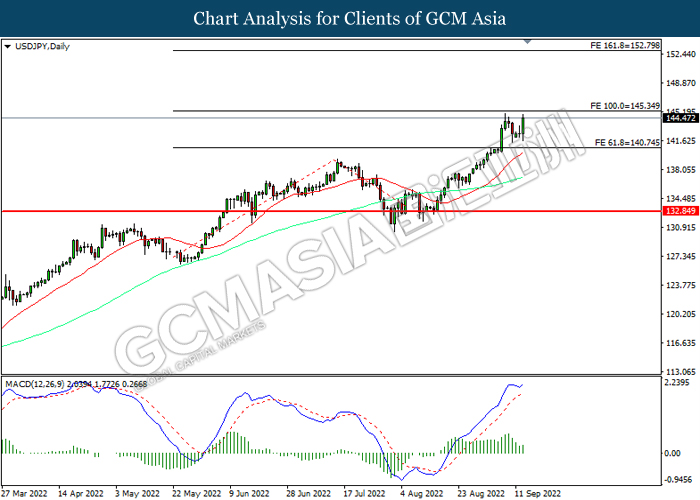

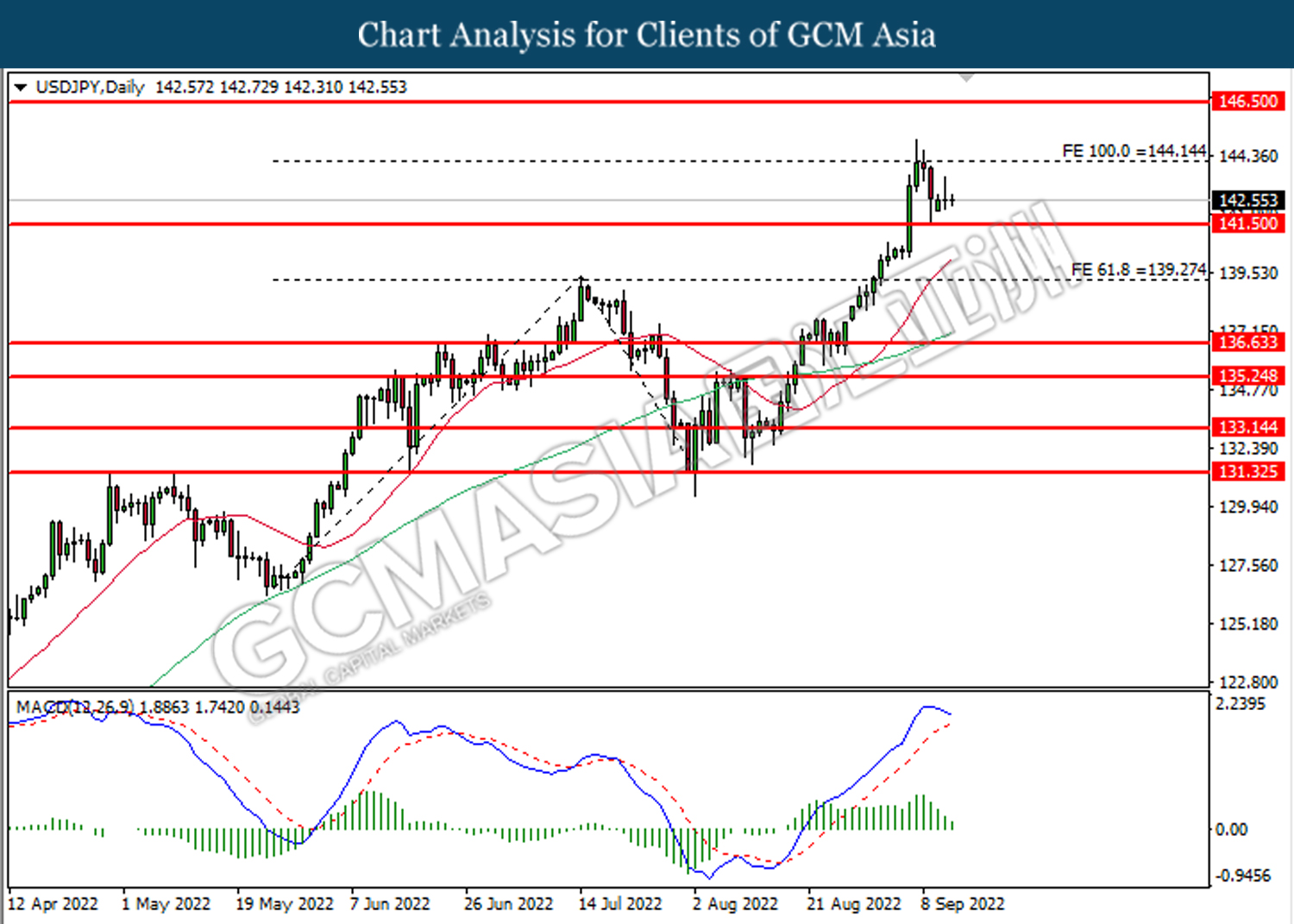

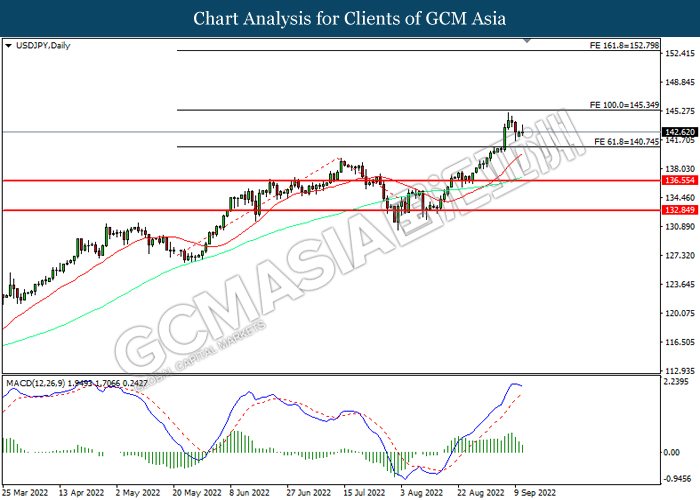

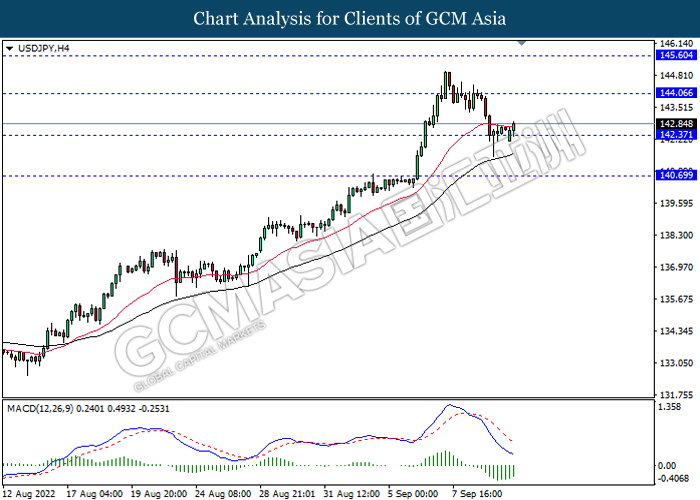

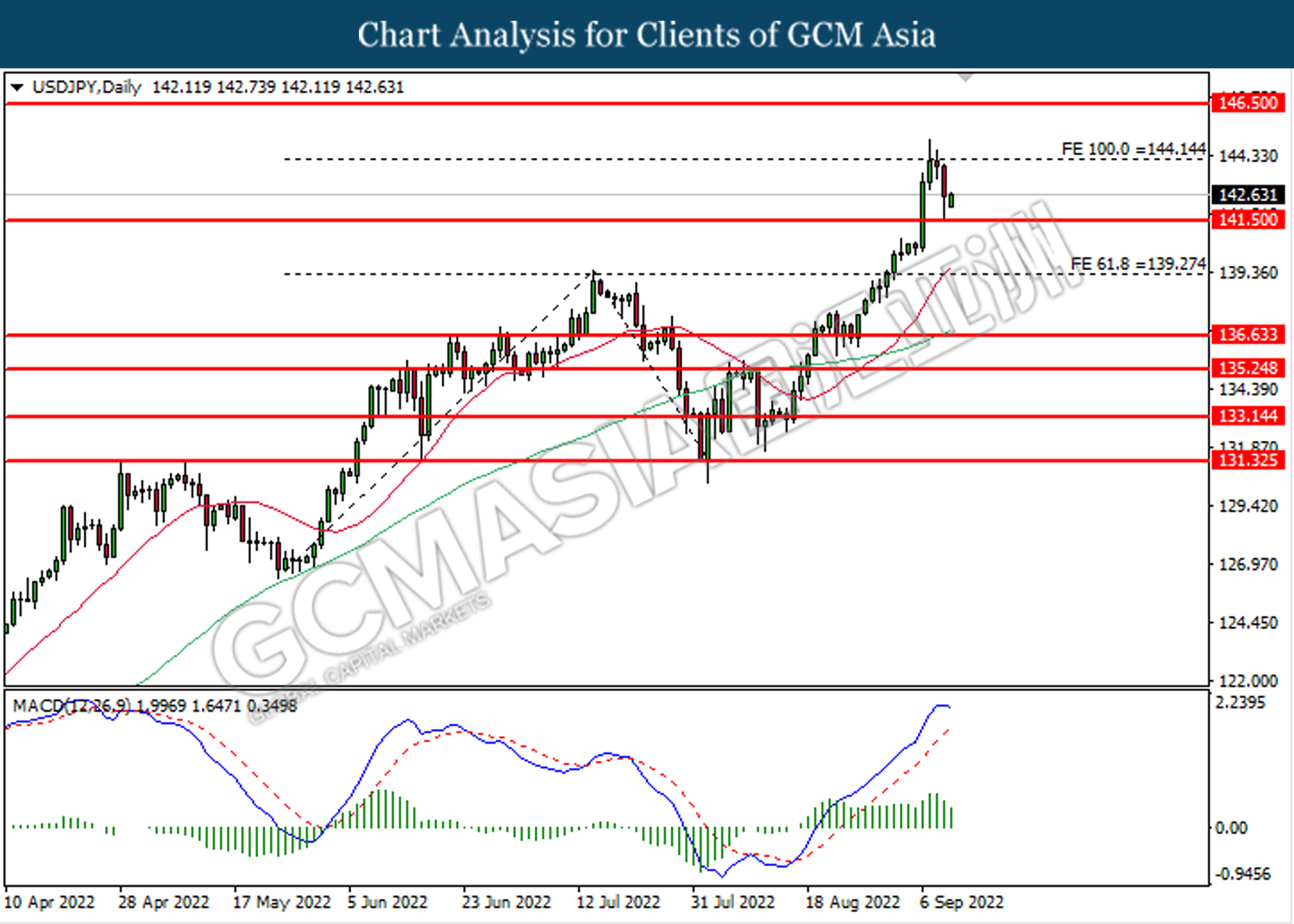

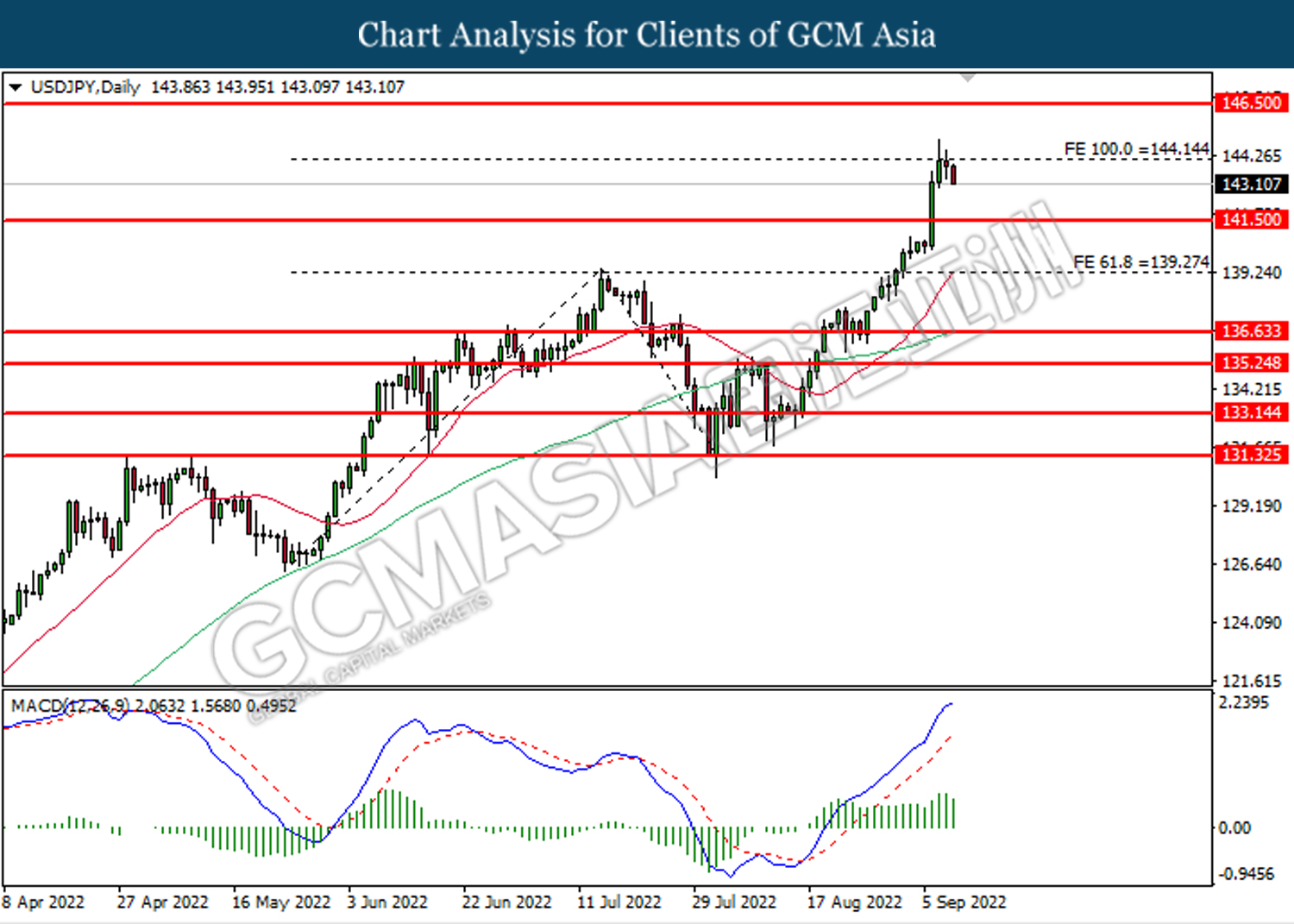

USDJPY, Daily: USDJPY was traded higher following prior rebound from the lower level. However, MACD which illustrated bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

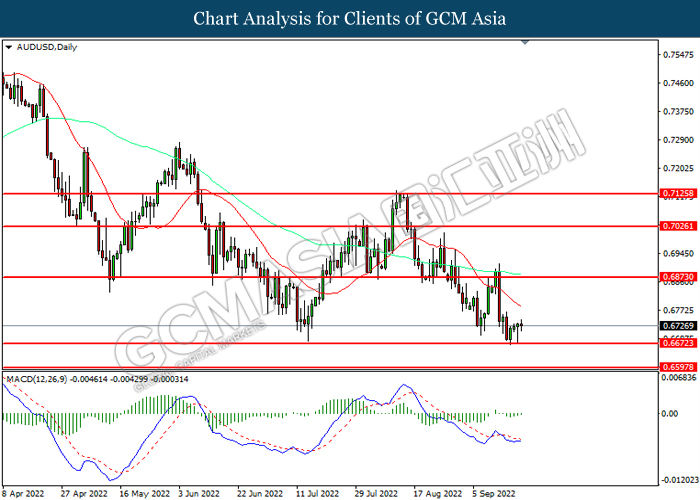

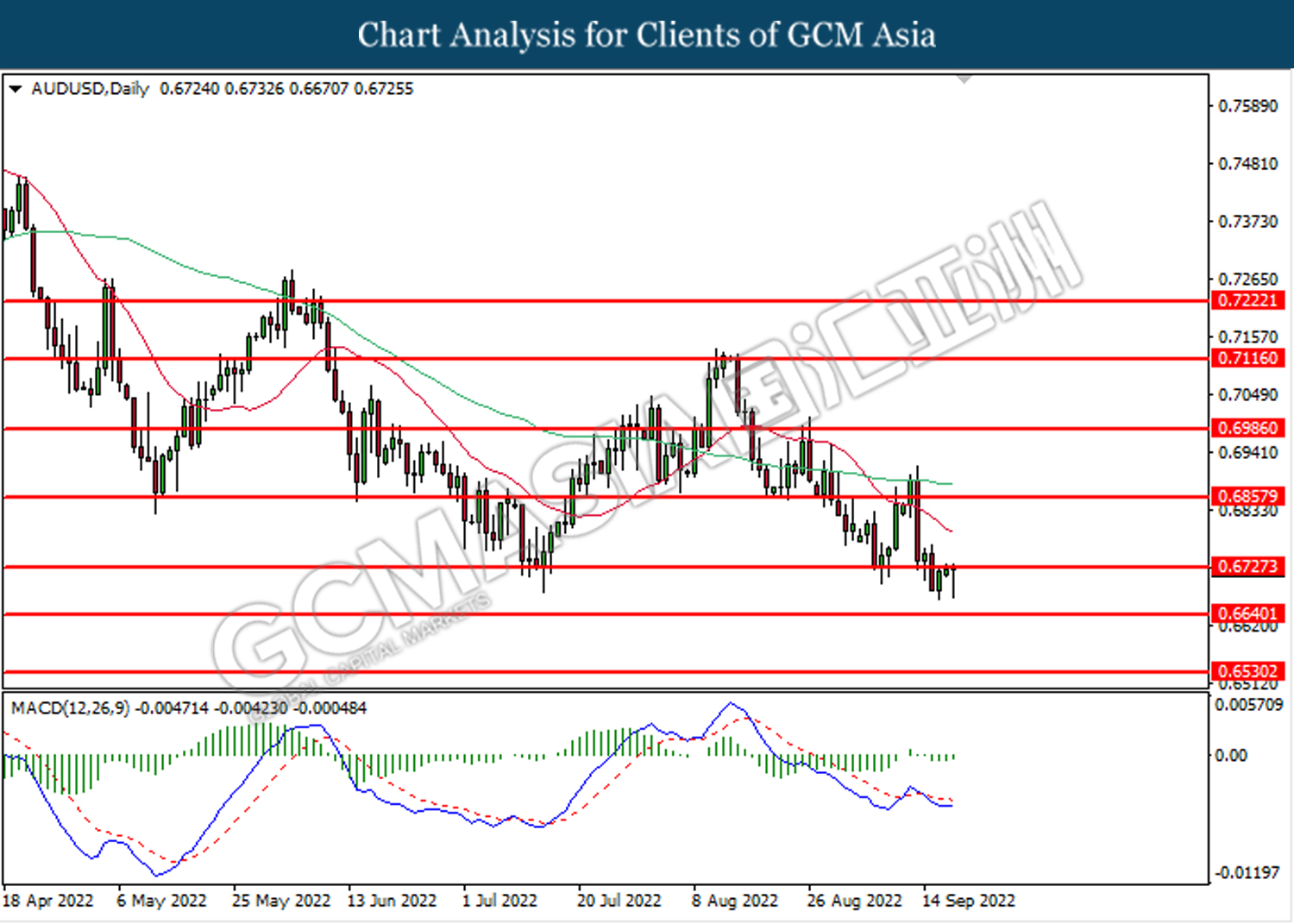

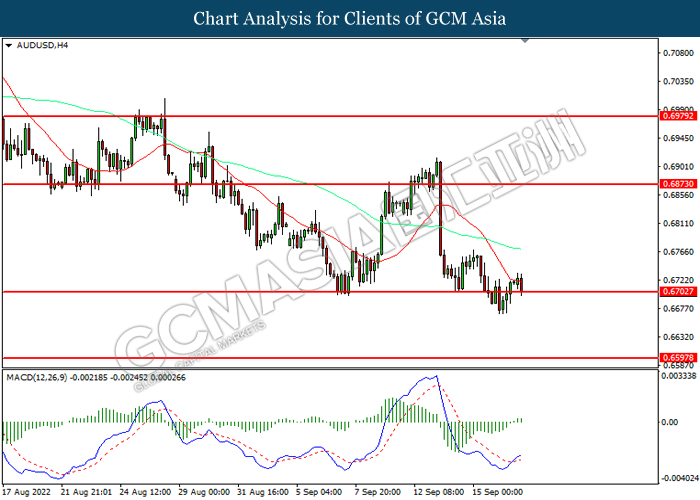

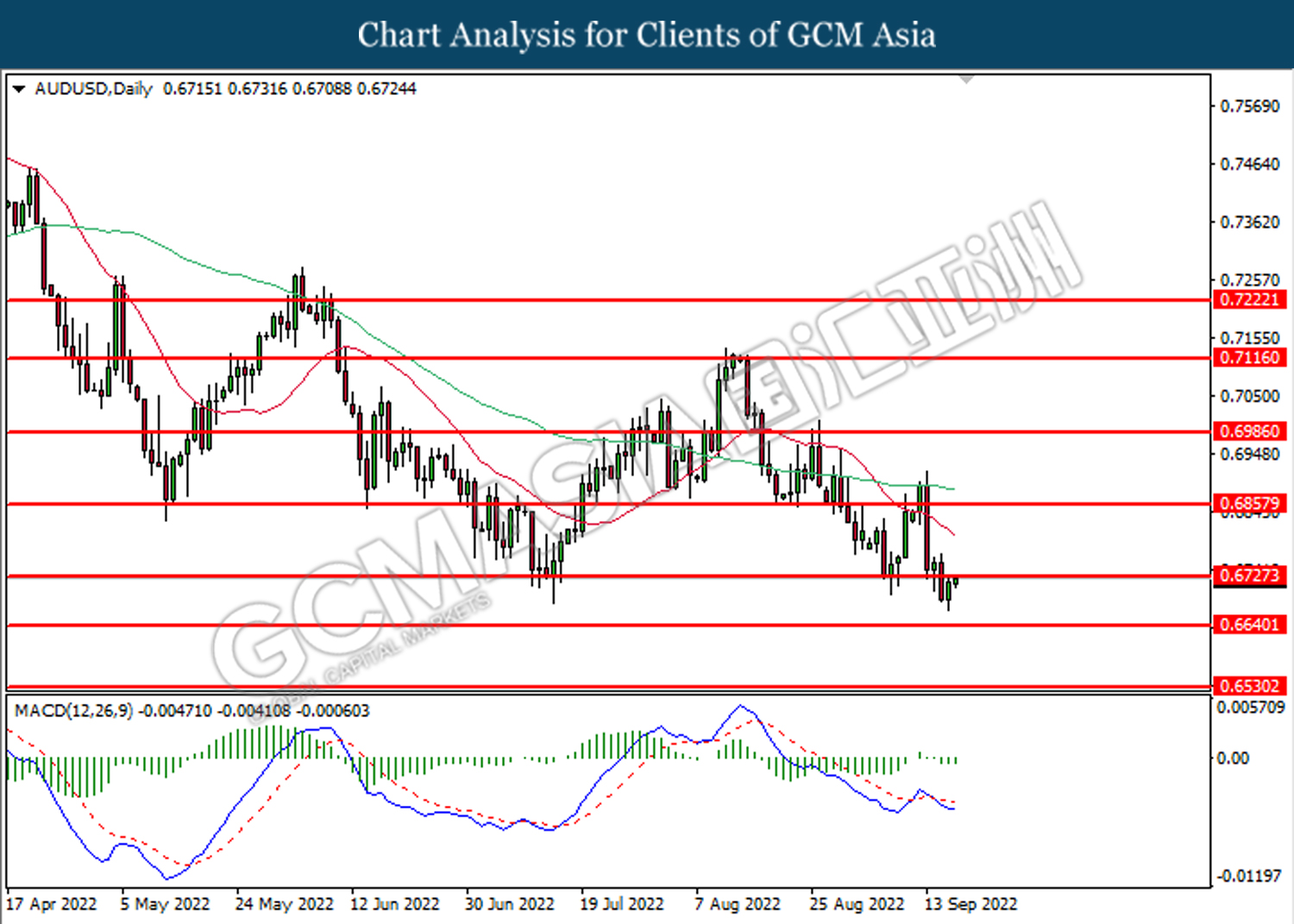

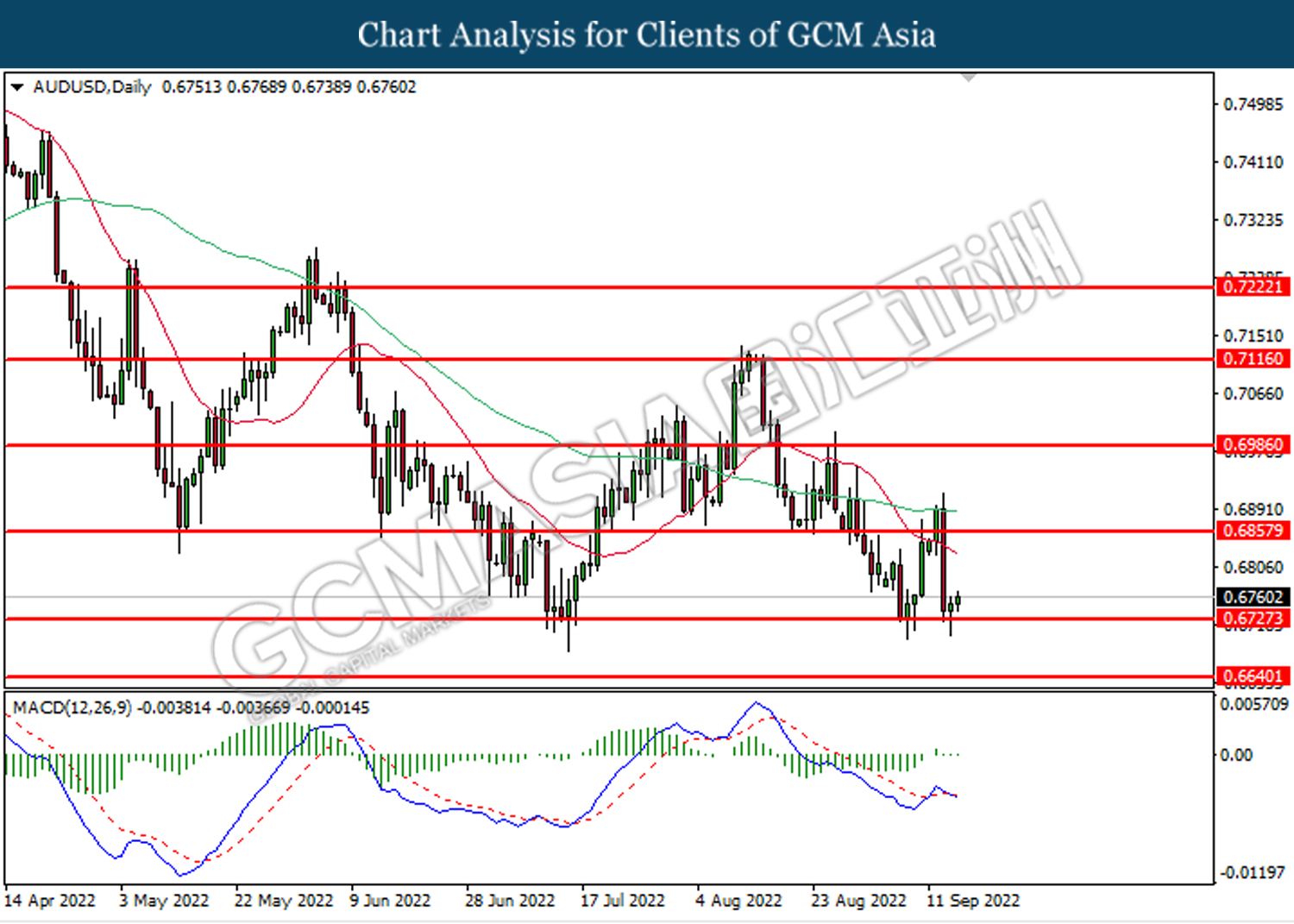

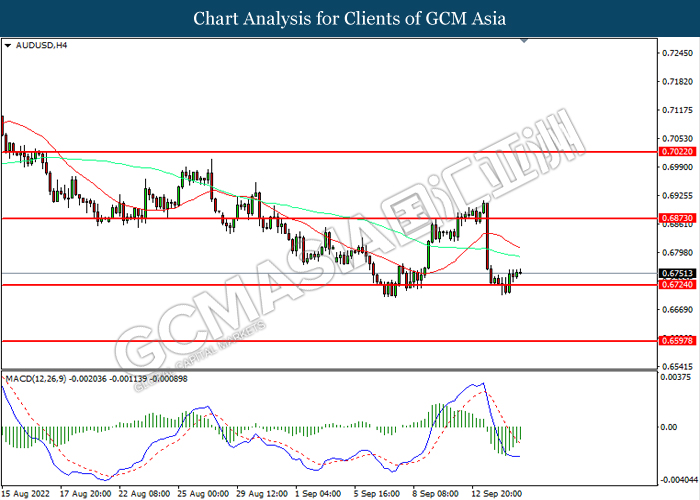

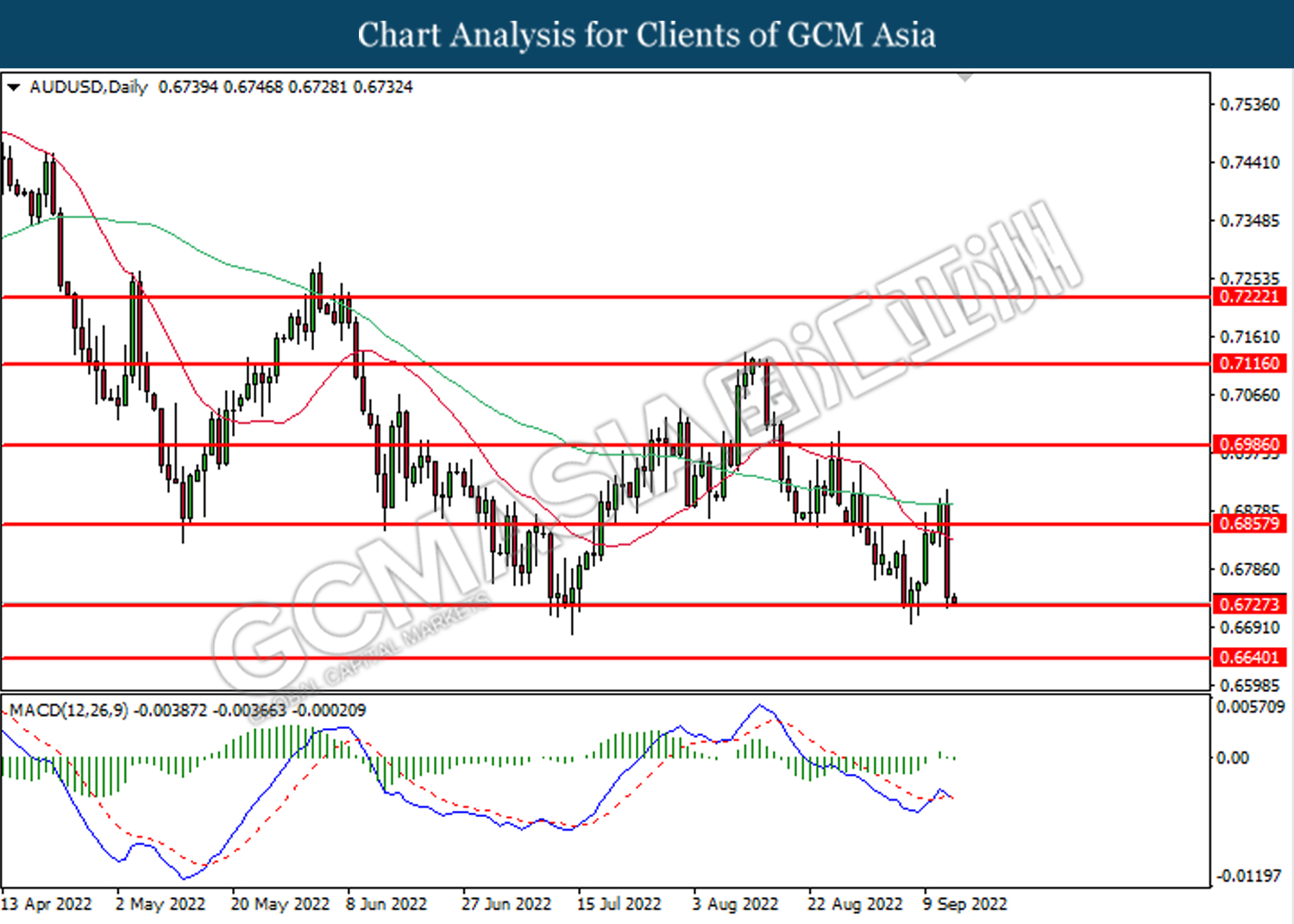

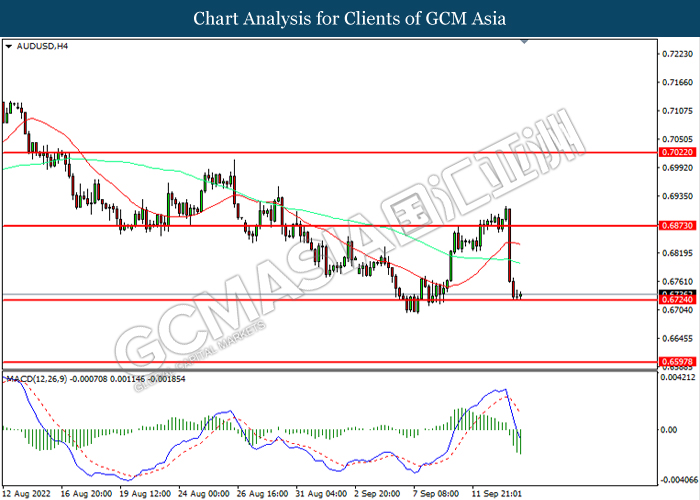

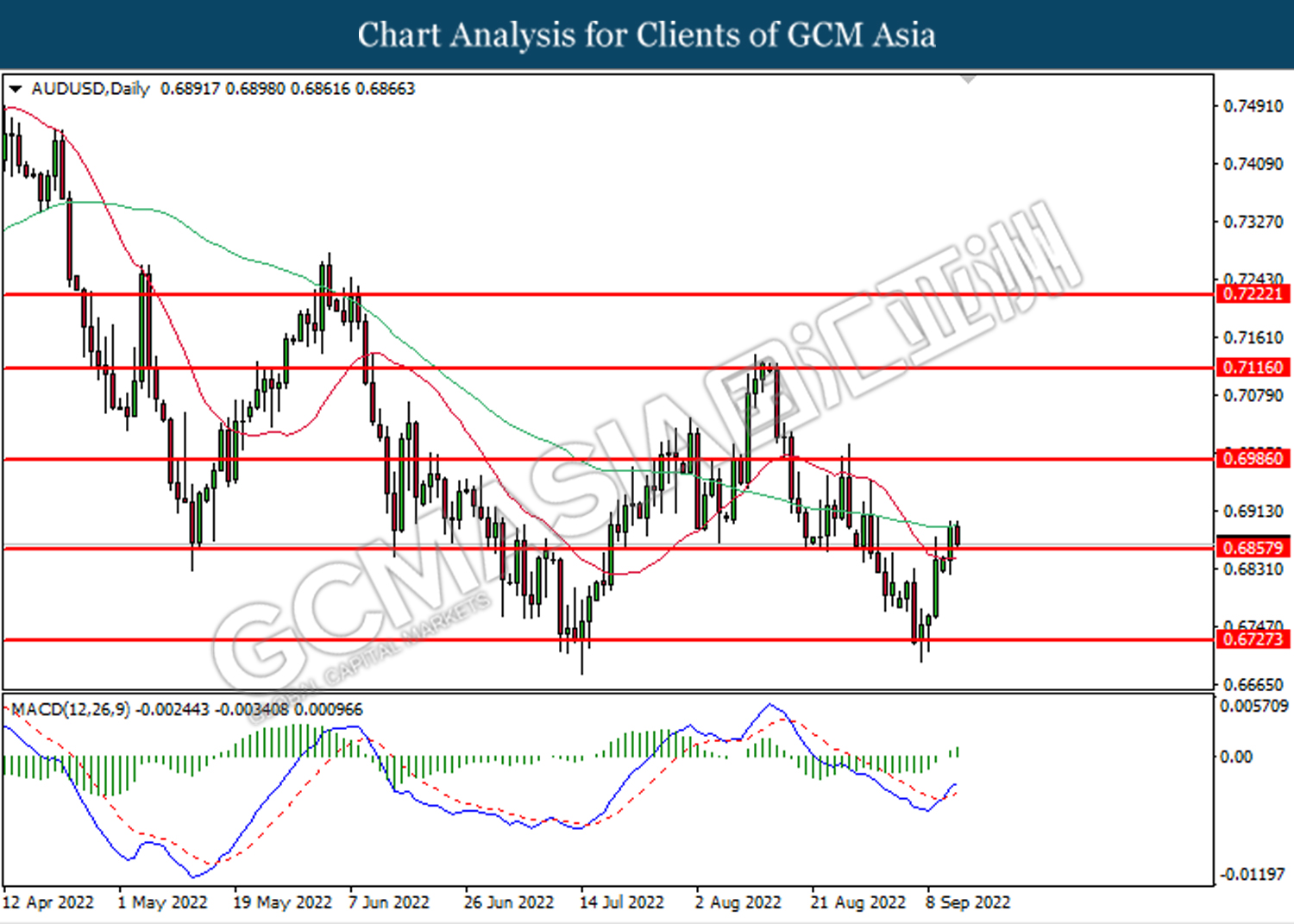

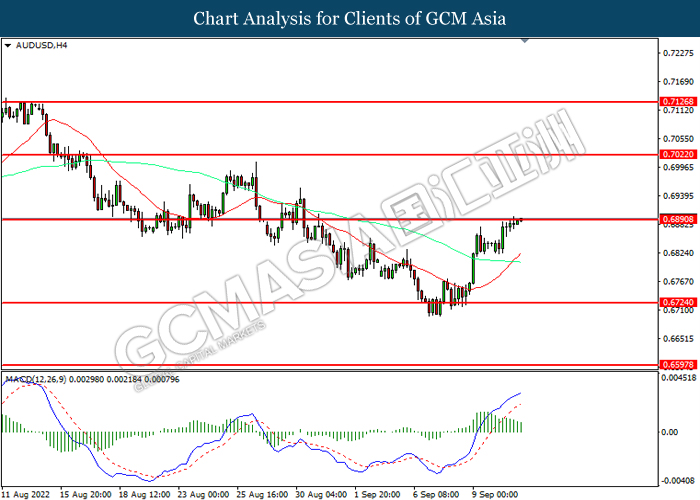

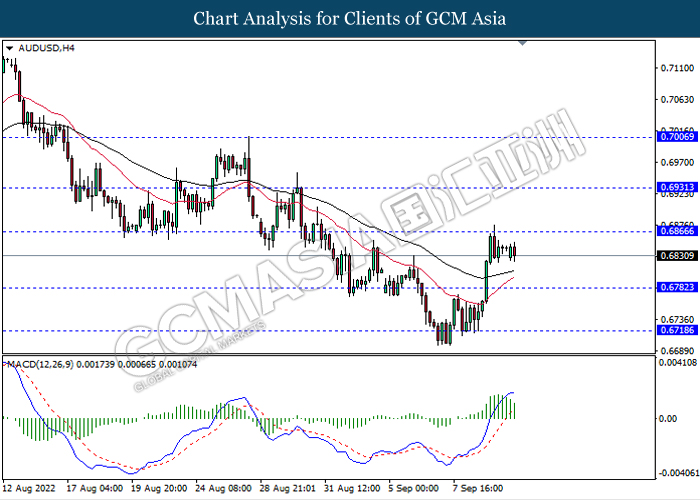

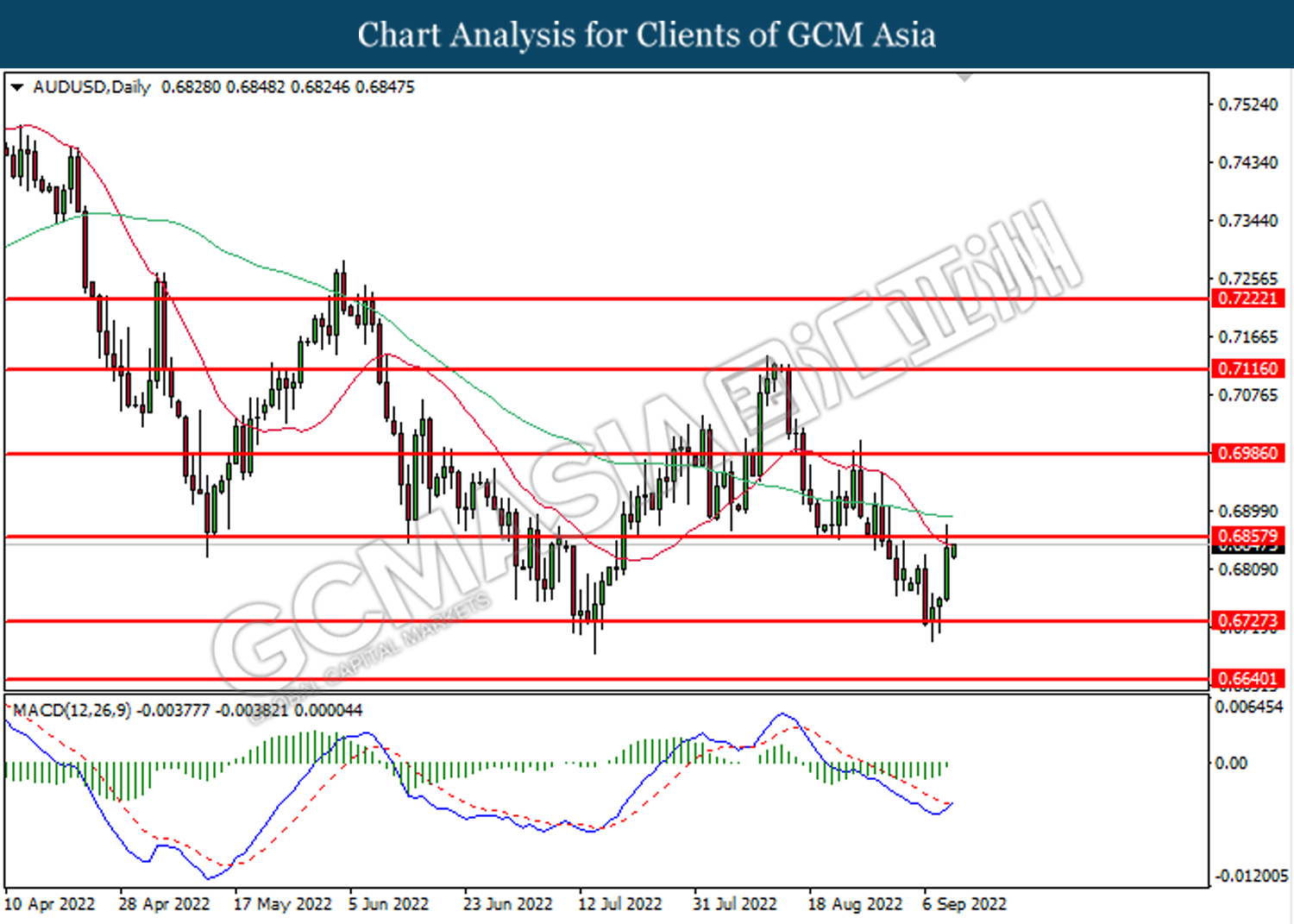

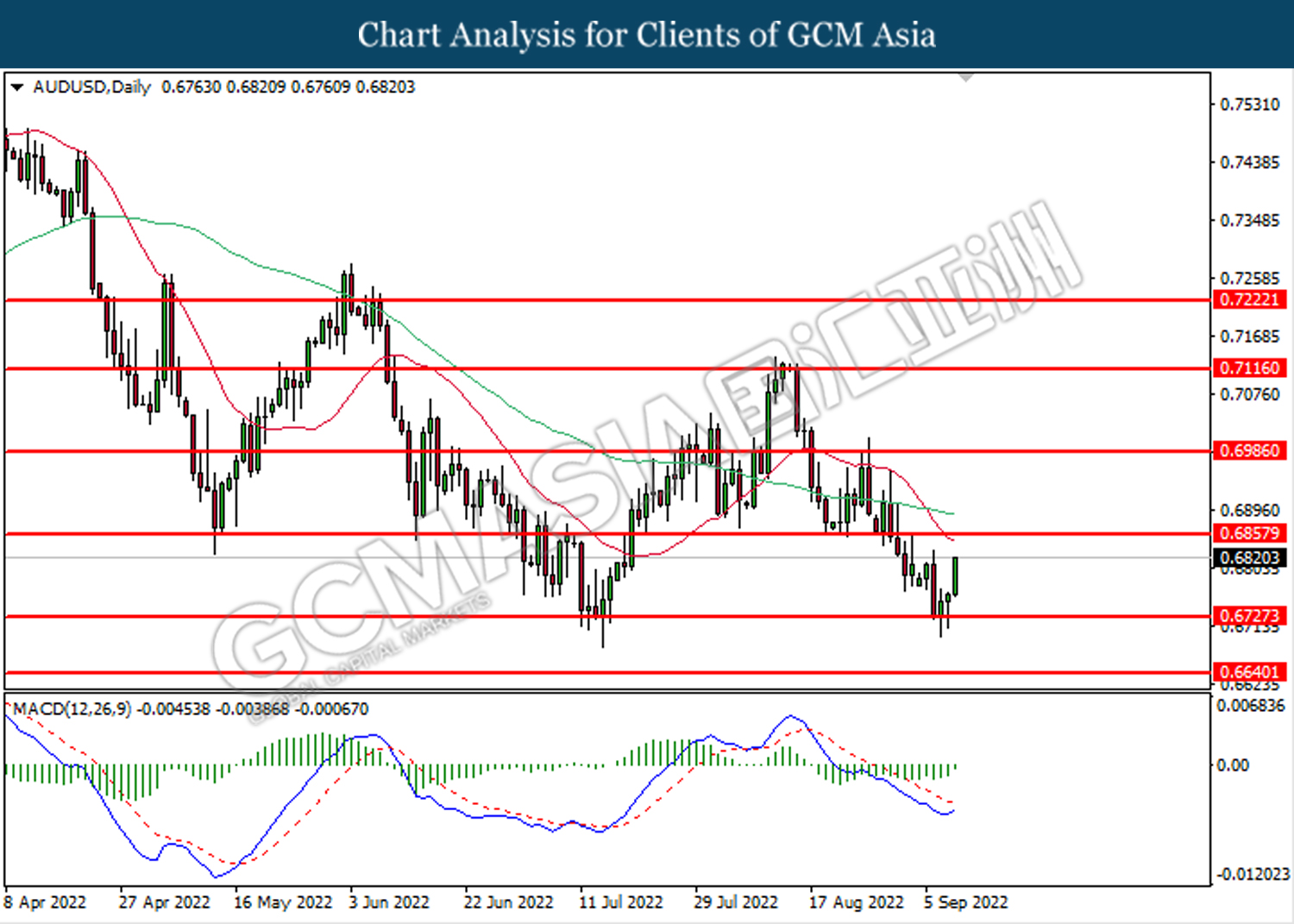

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

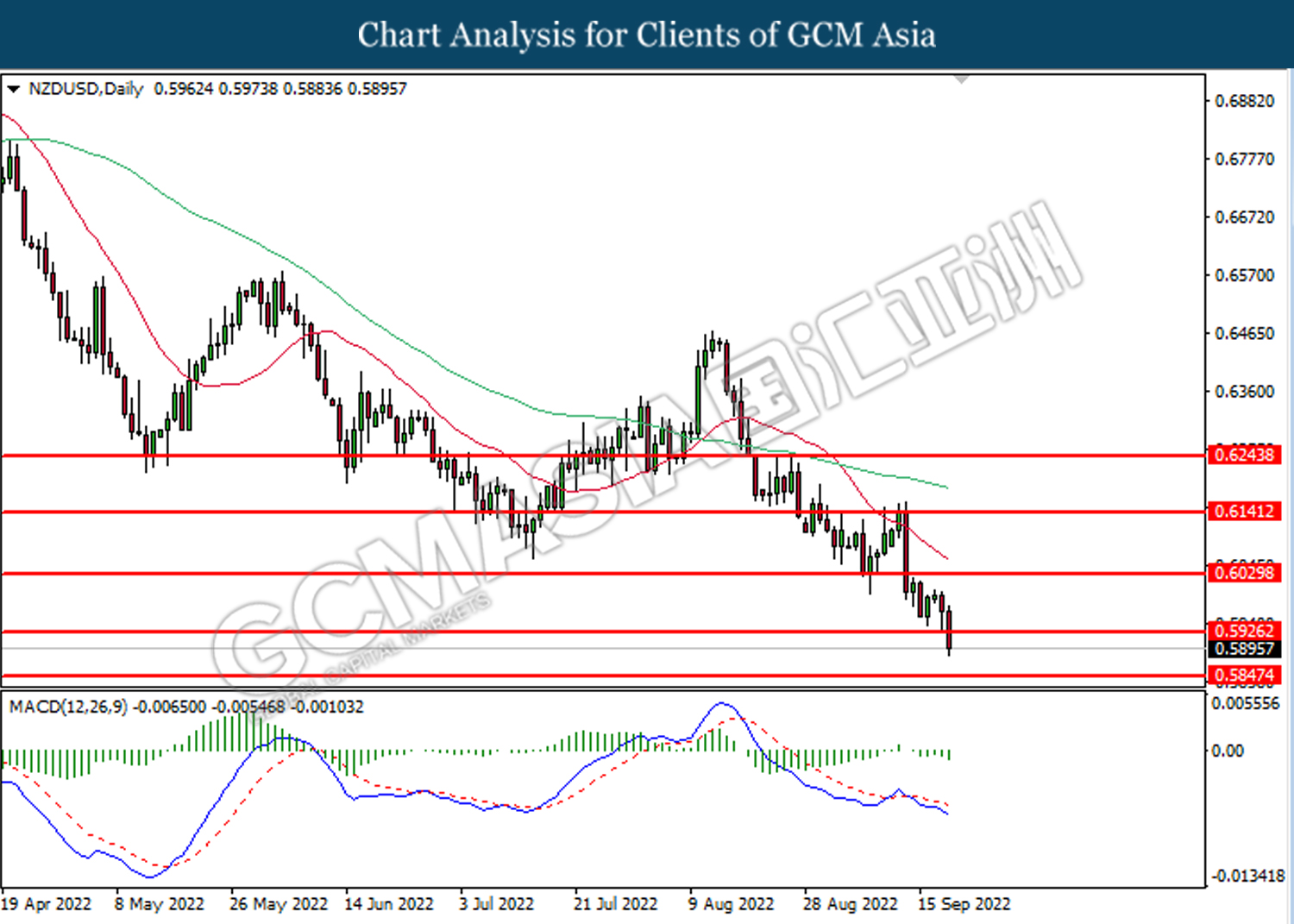

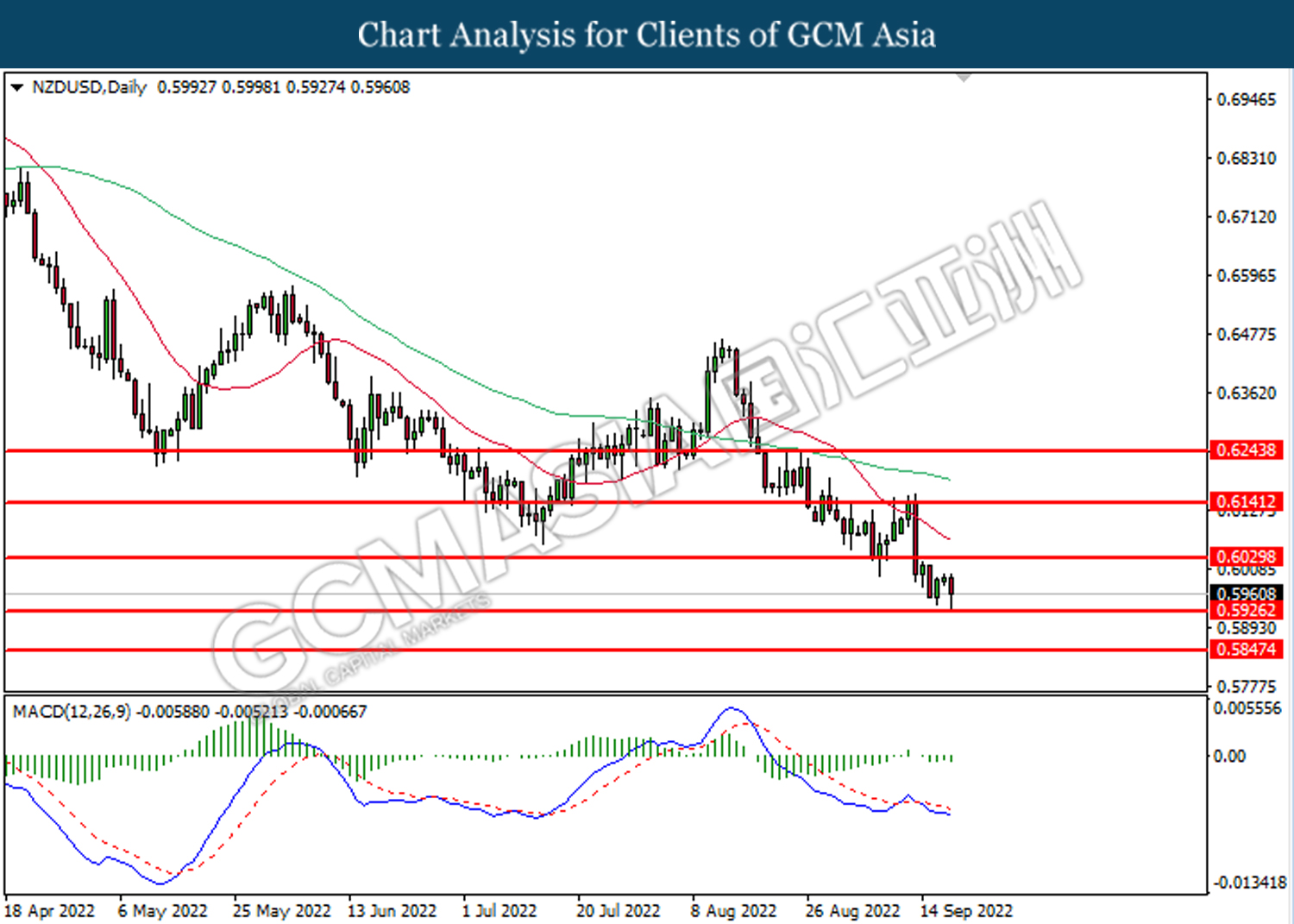

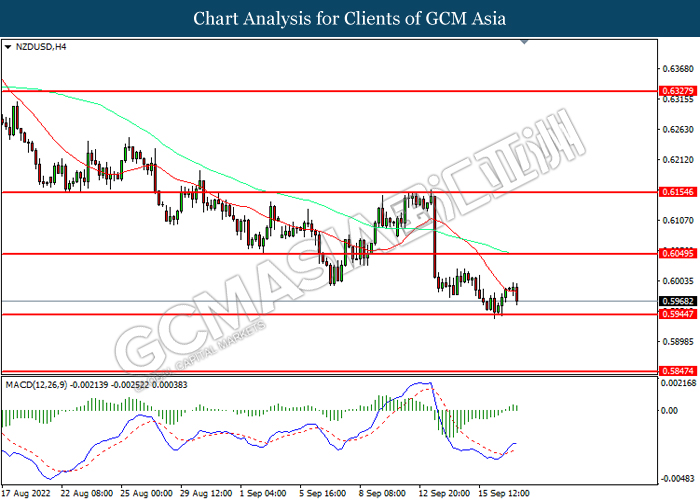

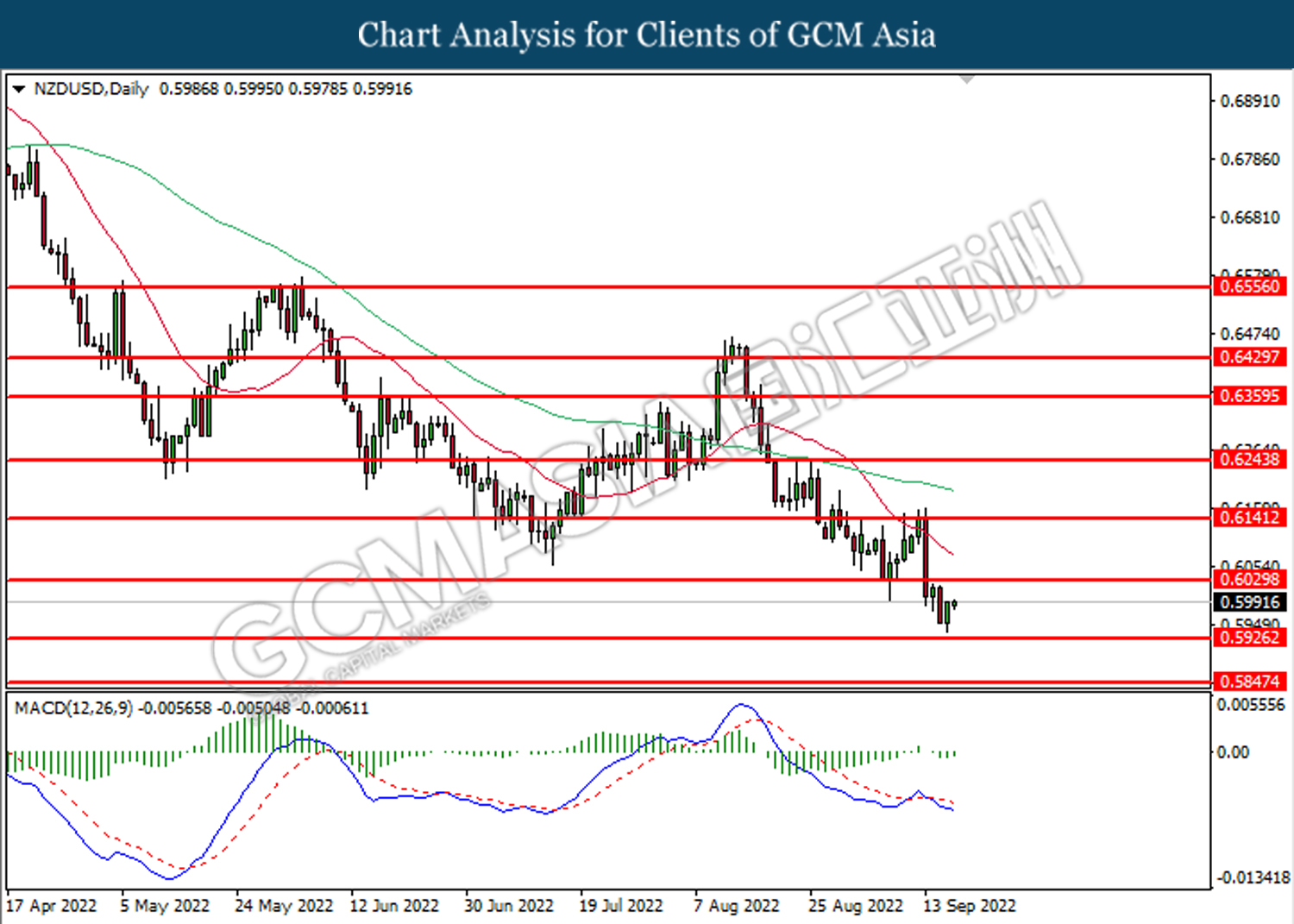

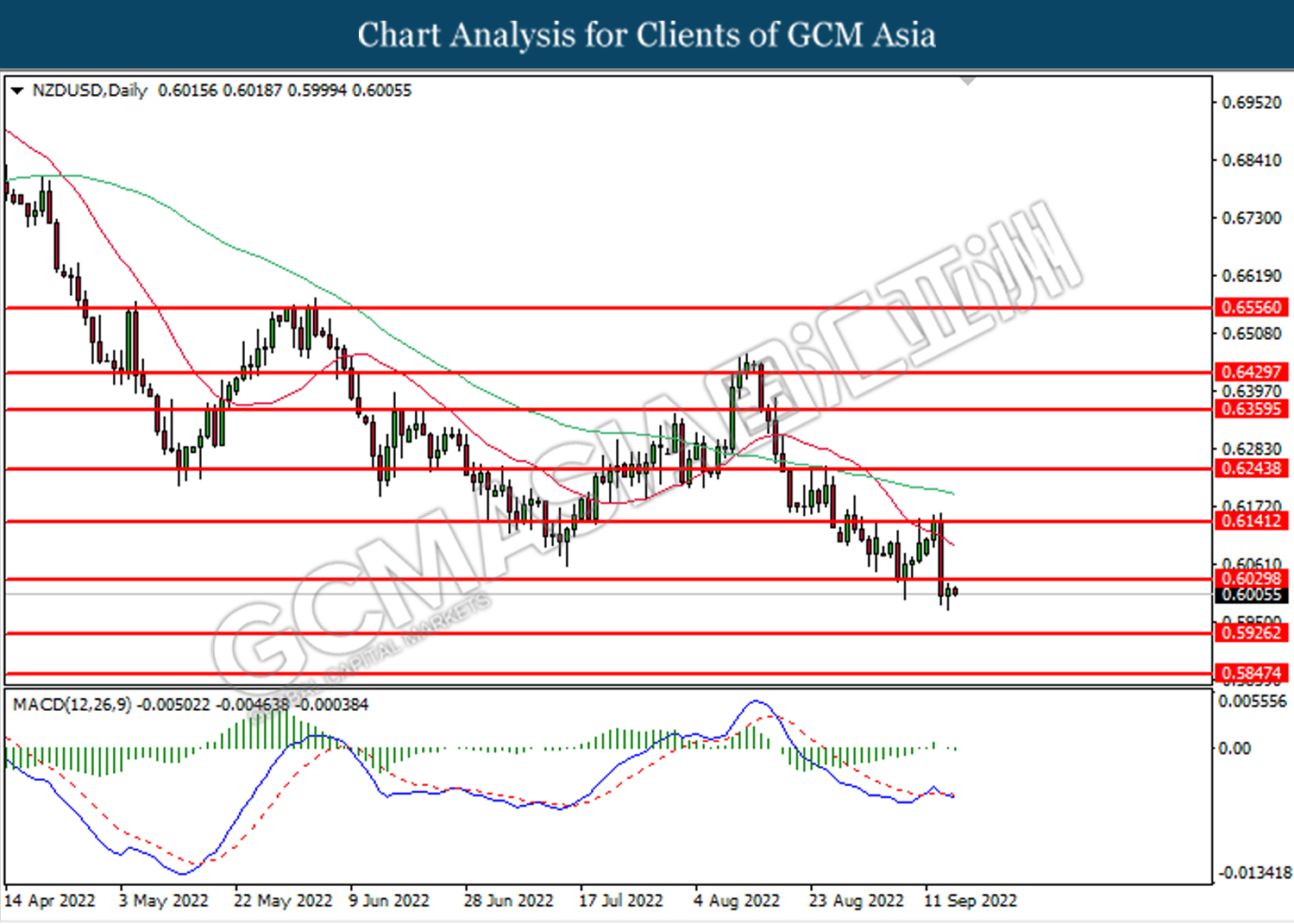

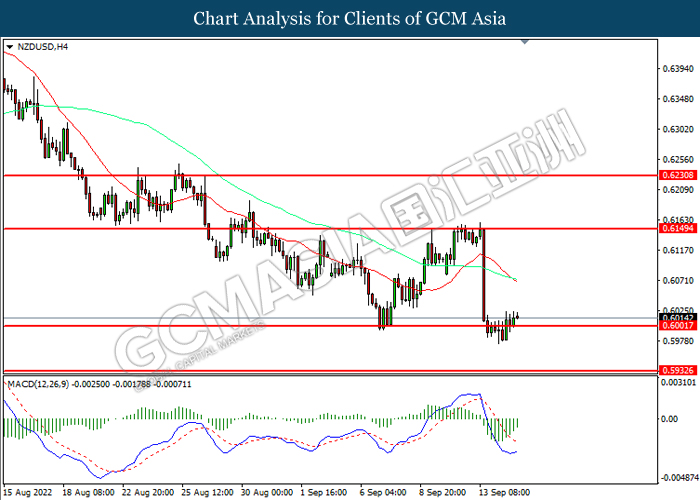

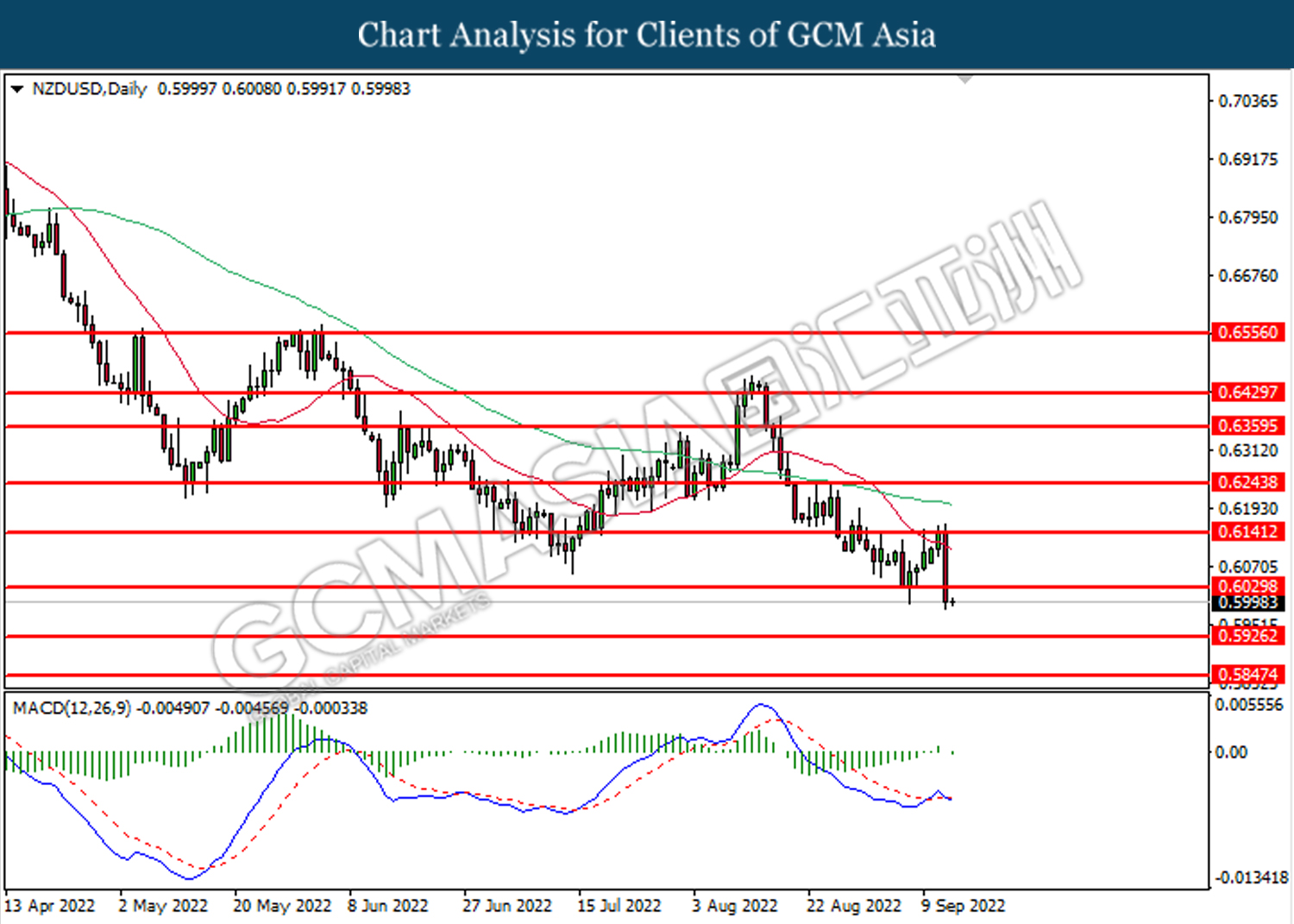

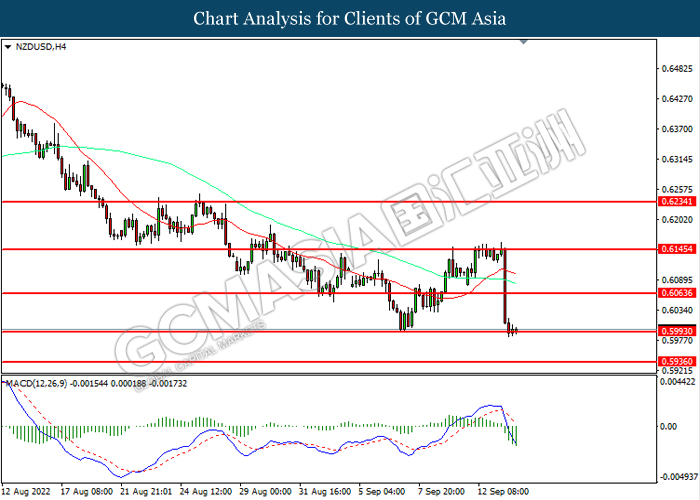

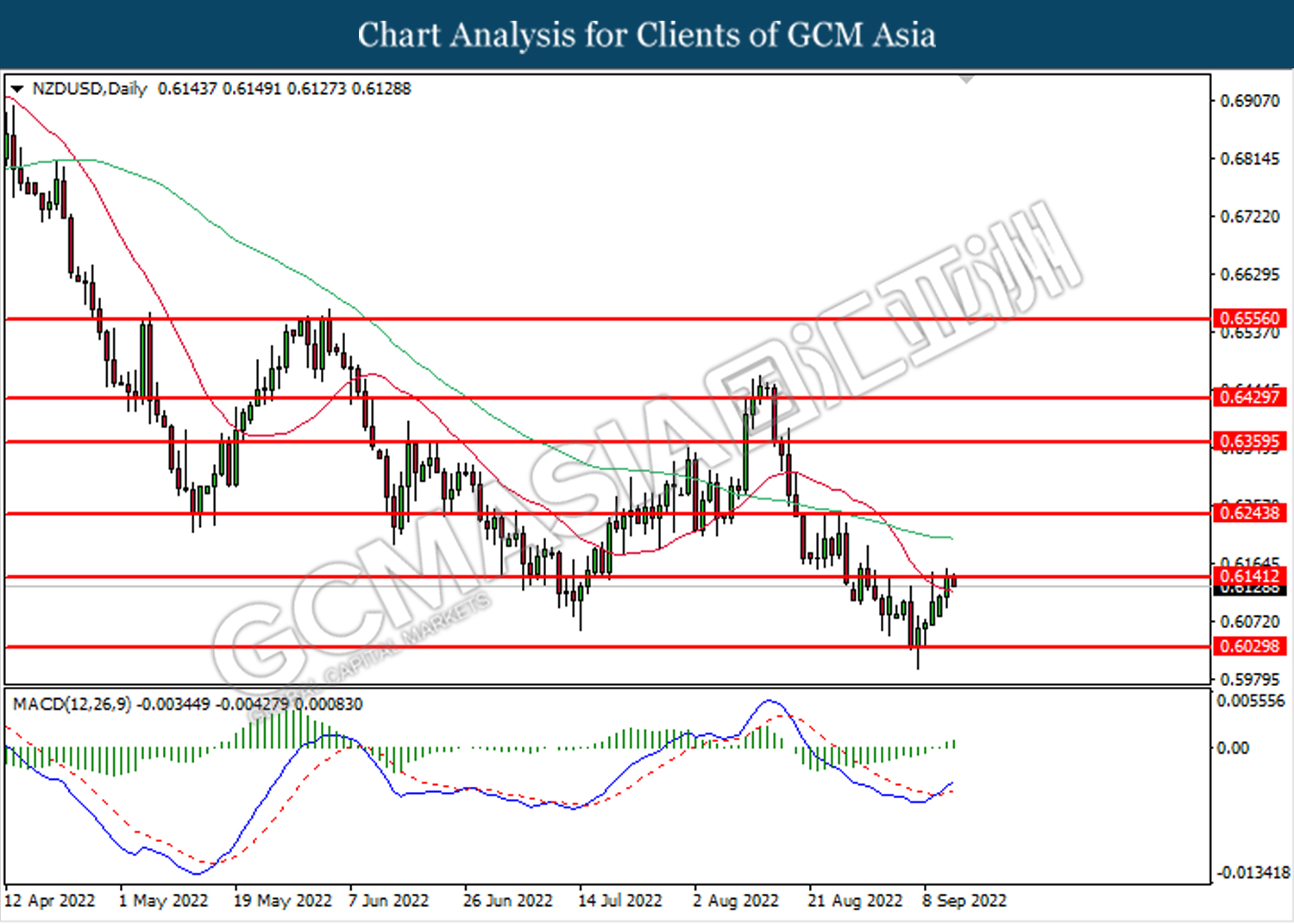

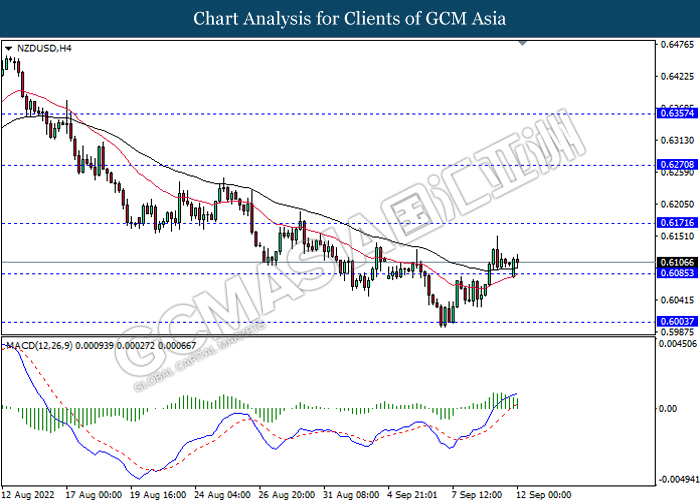

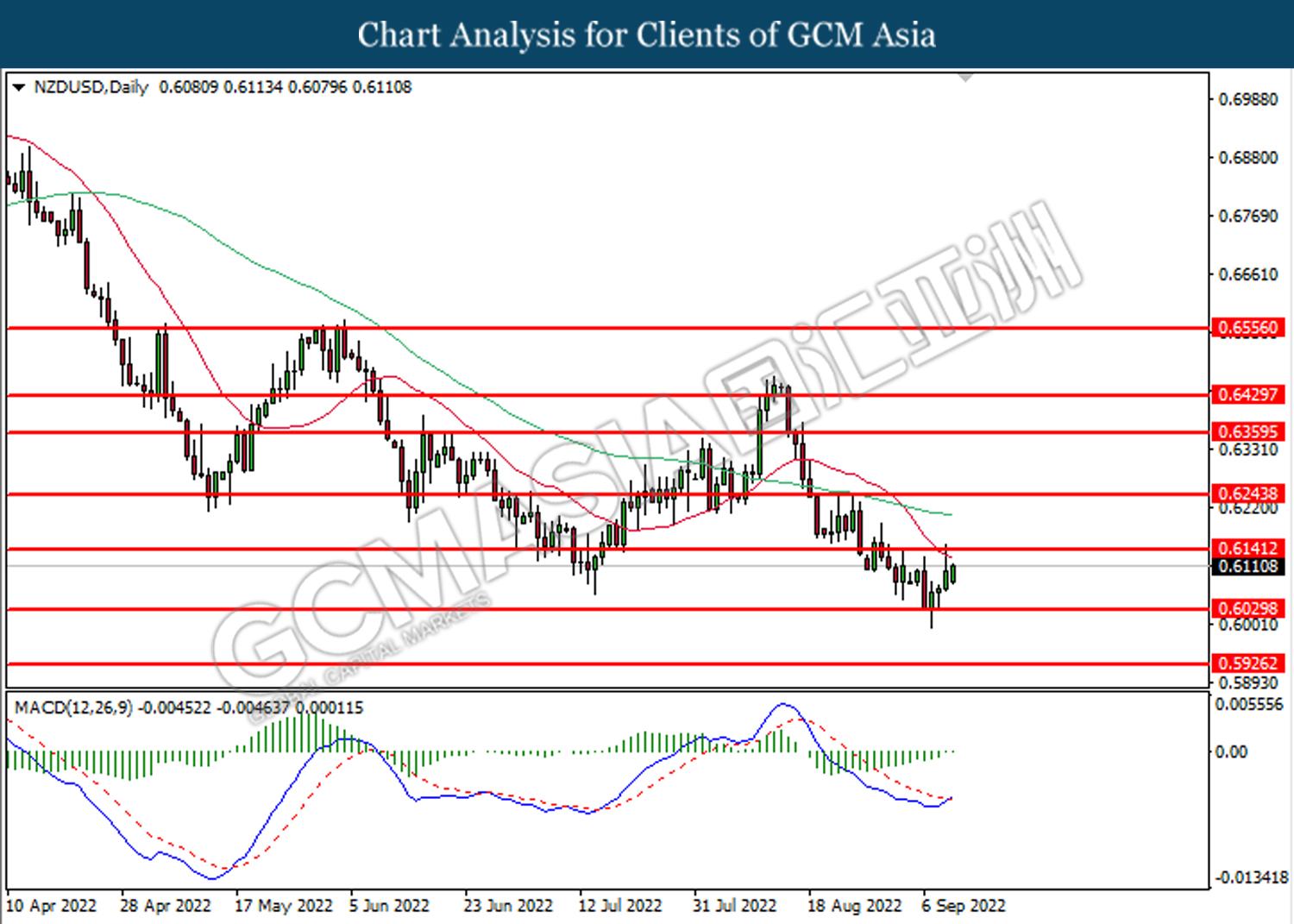

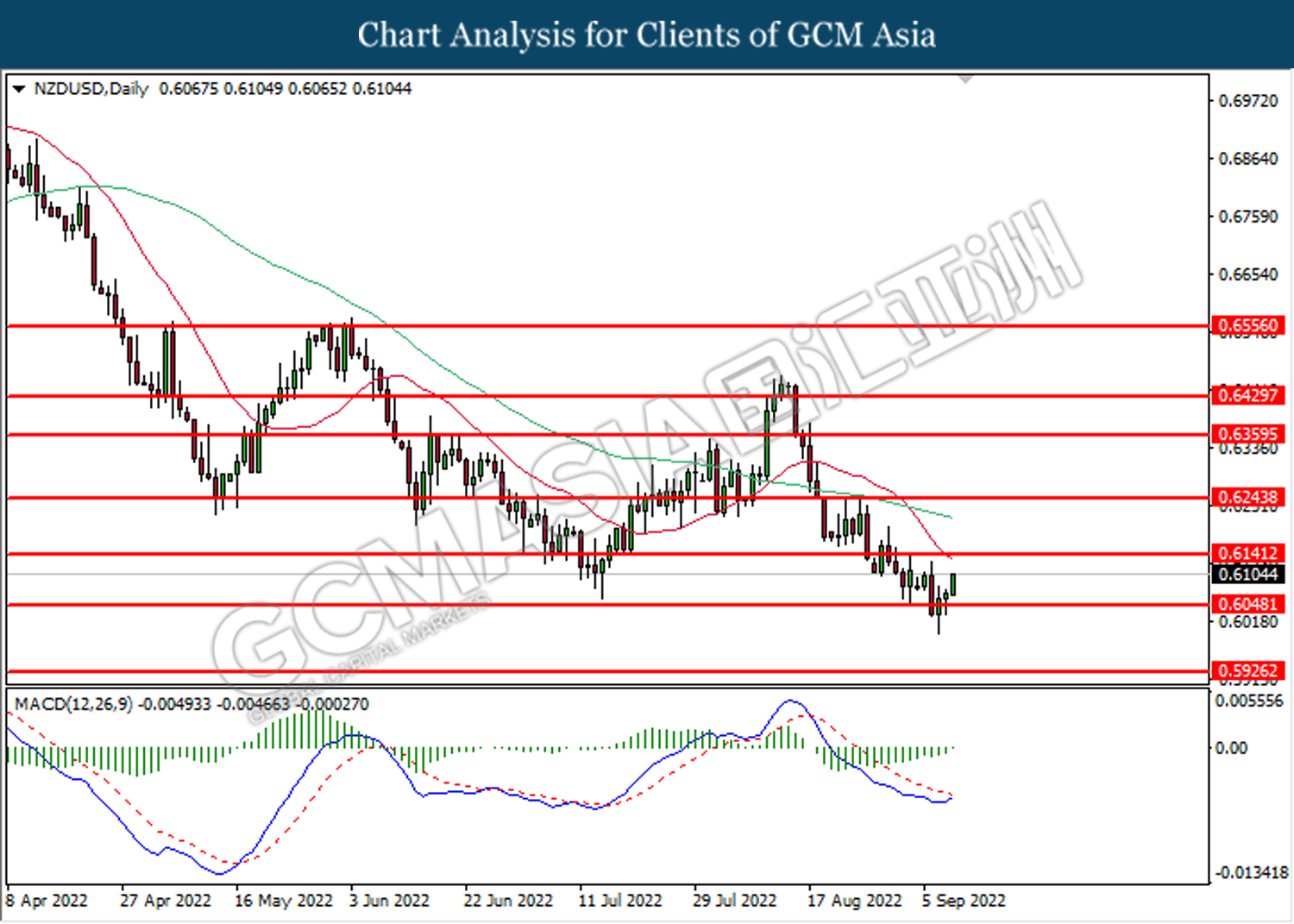

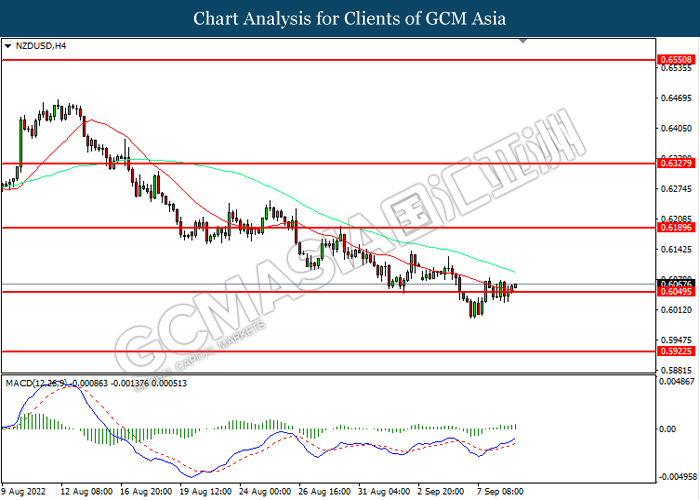

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.5925. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closes below the support level.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

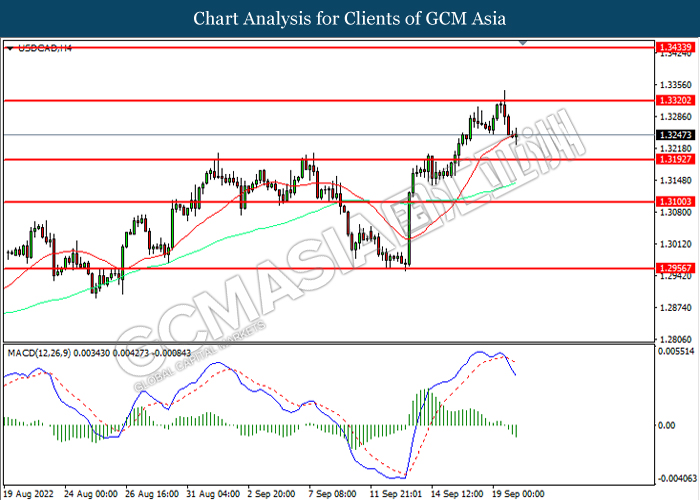

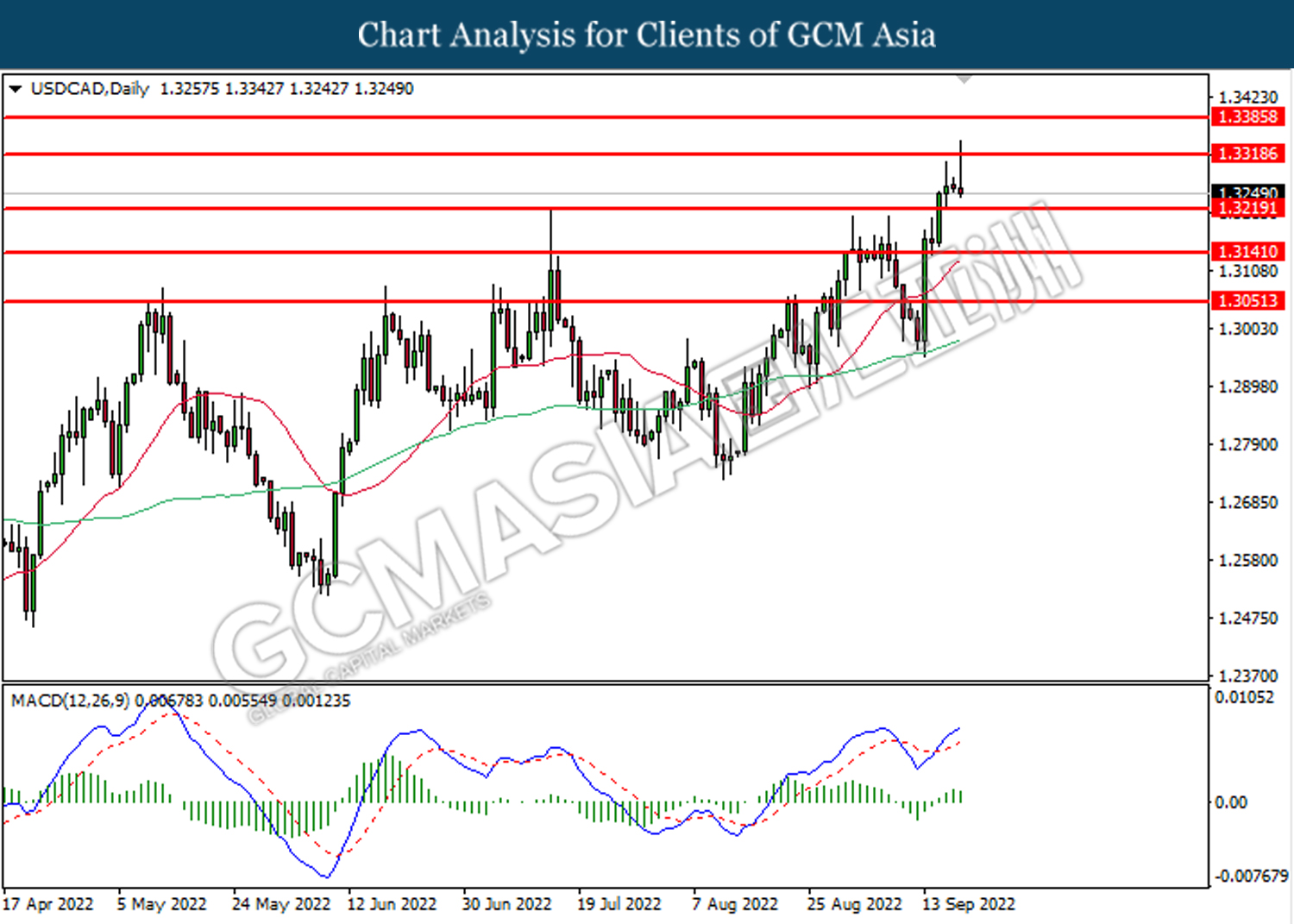

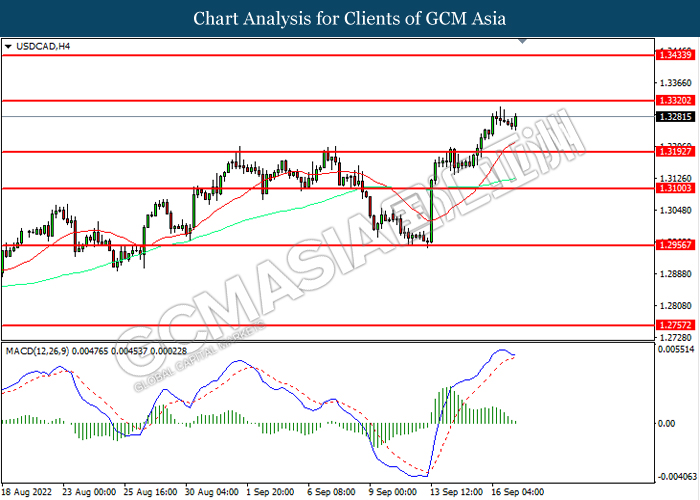

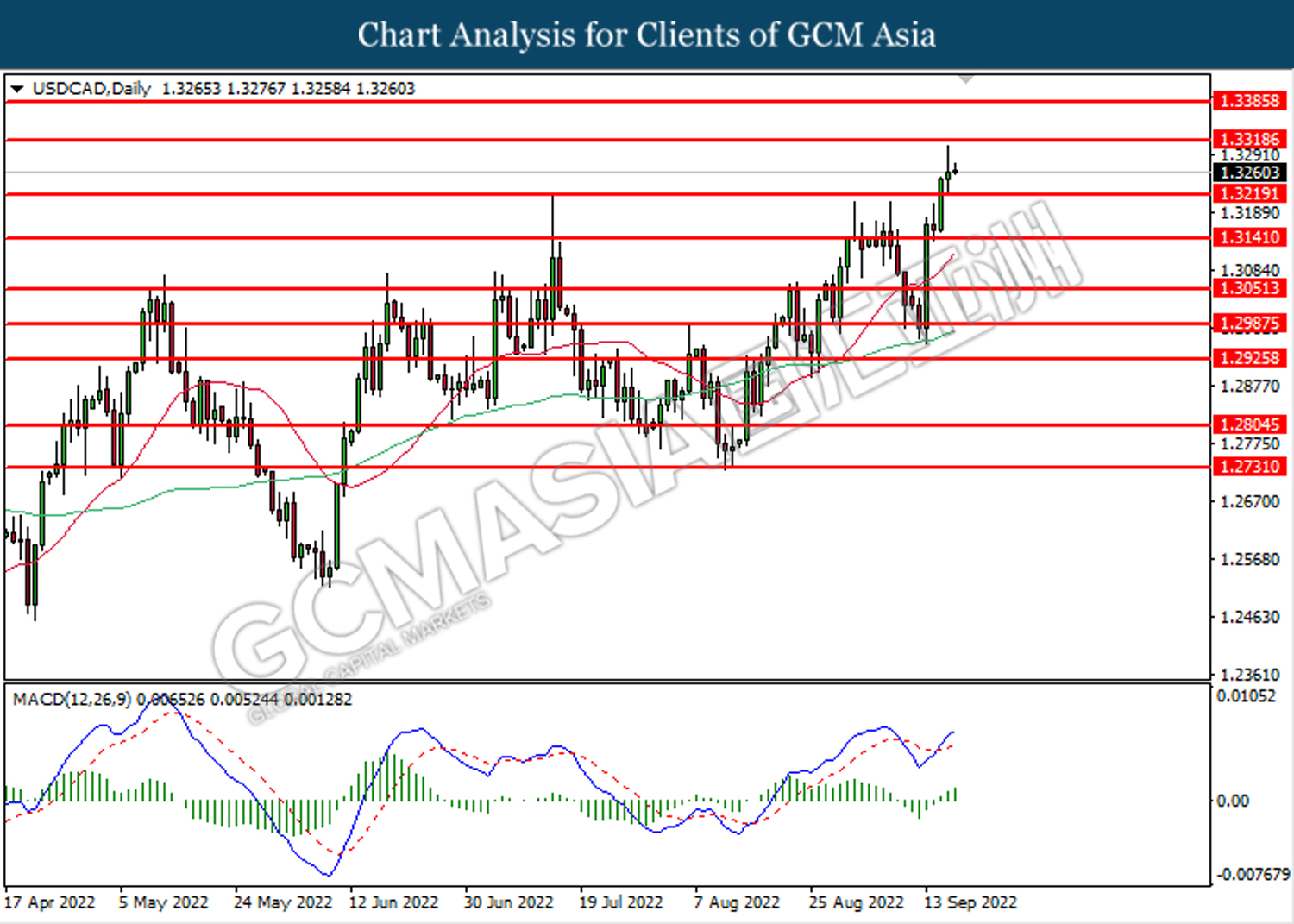

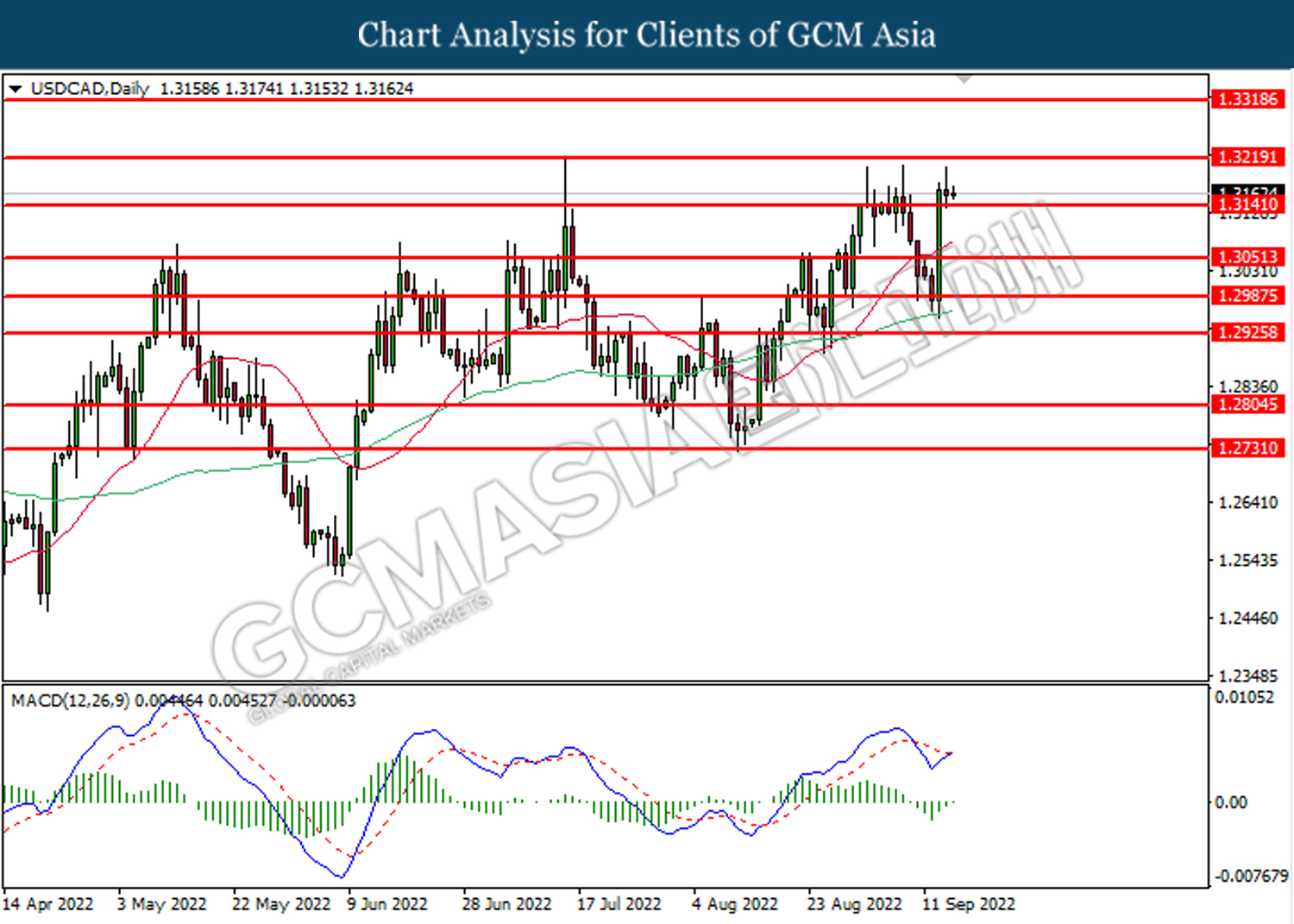

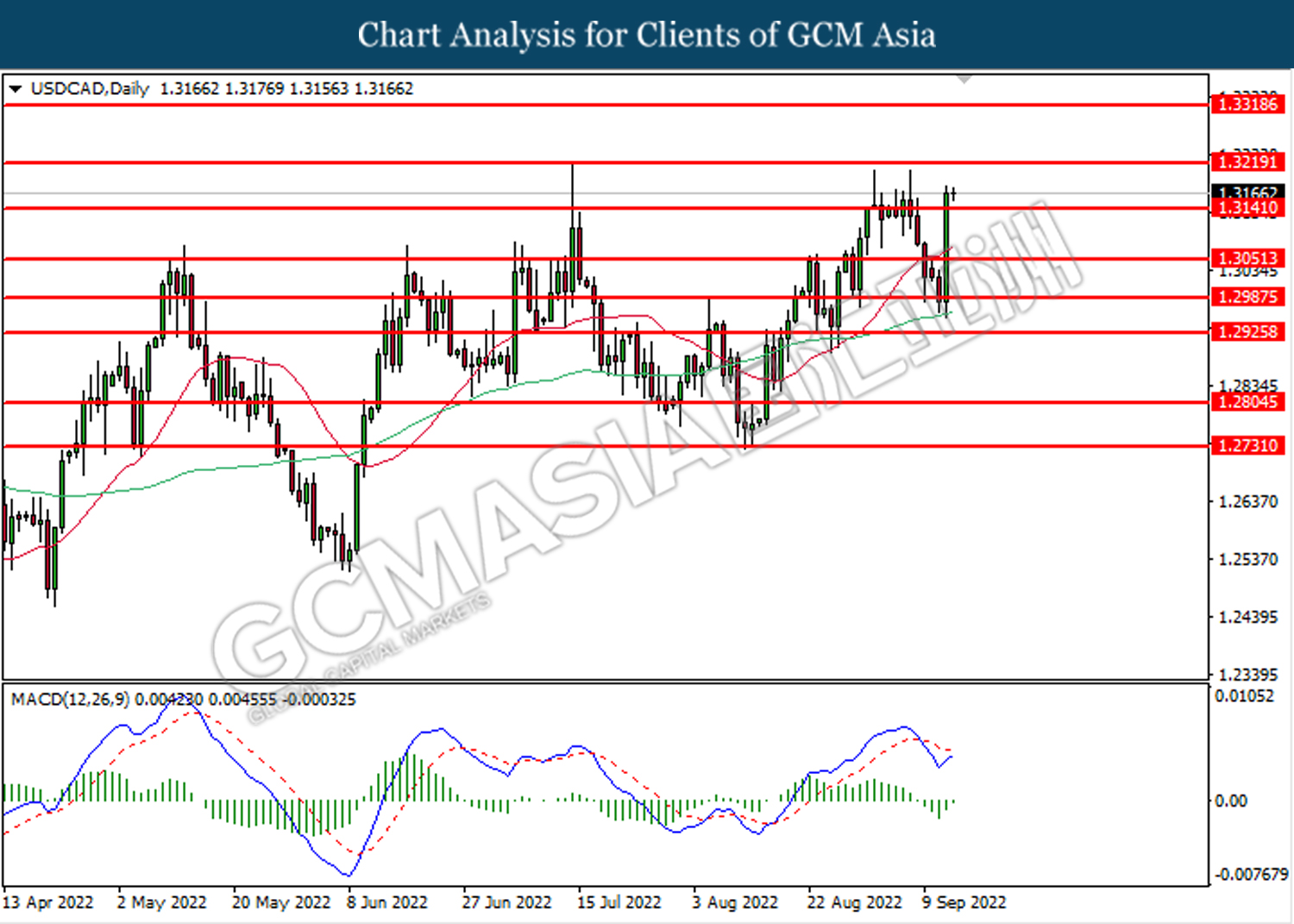

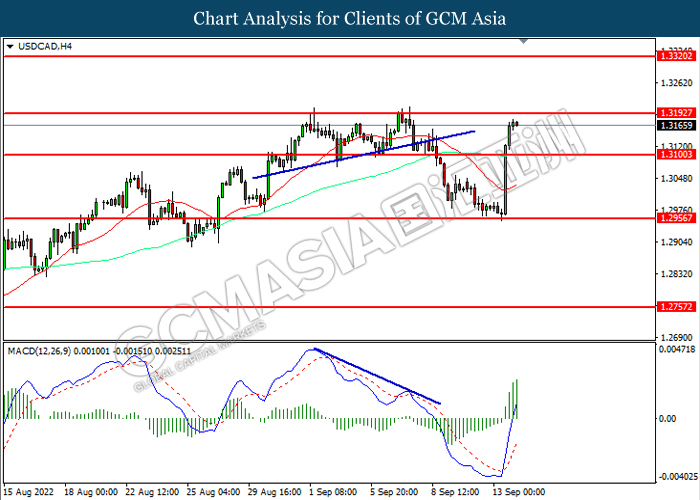

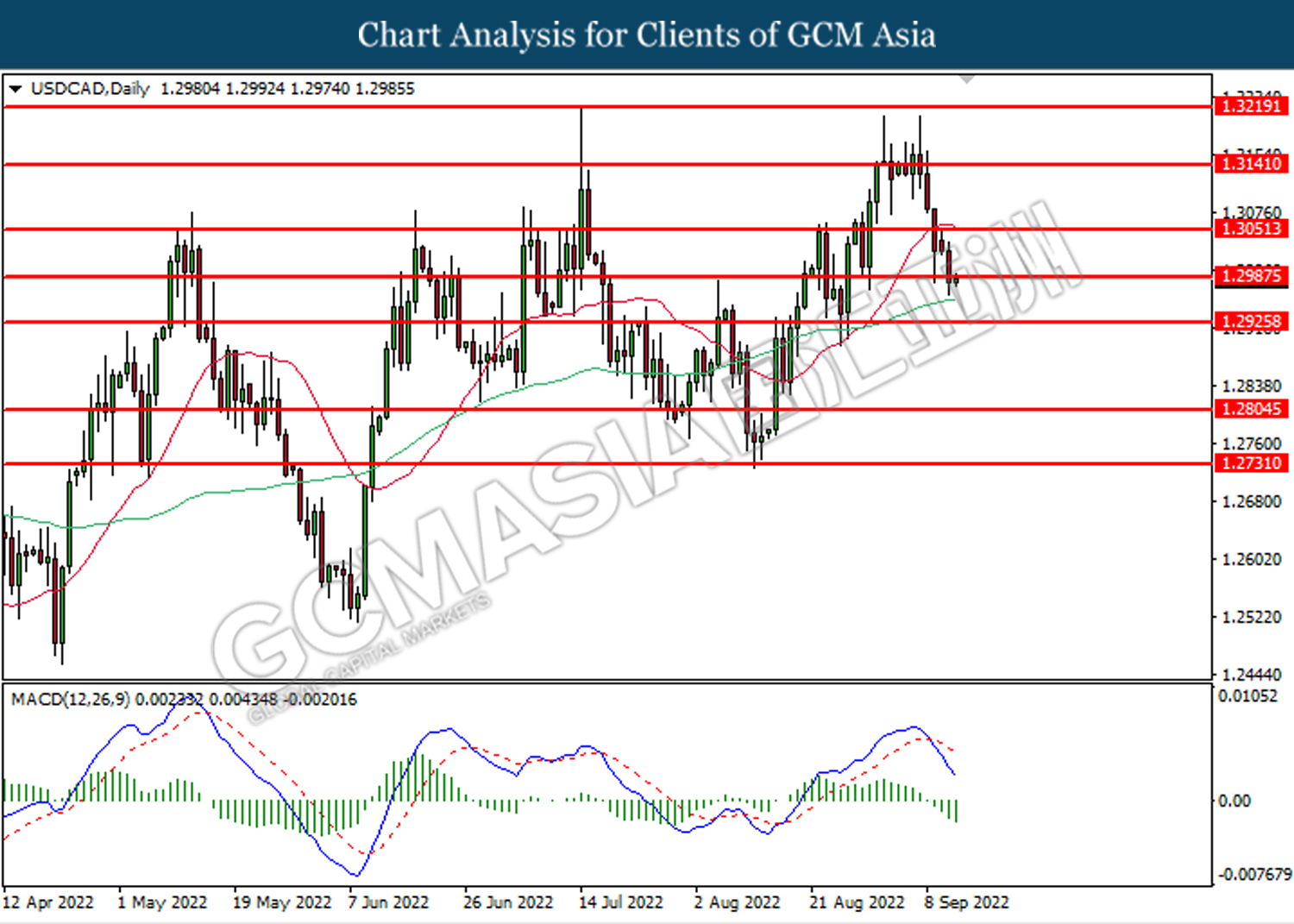

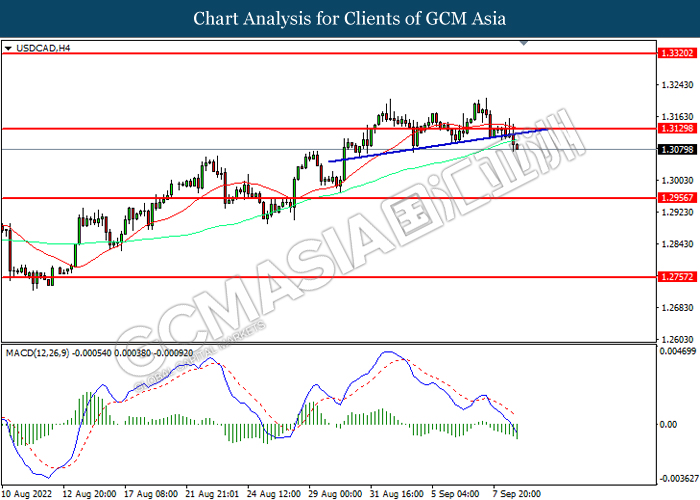

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3320. MACD which illustrated bullish momentum suggests the pair to extend gains after its candle successfully closes above the resistance level at 1.3320.

Resistance level: 1.3320, 1.3385

Support level: 1.3220, 1.3140

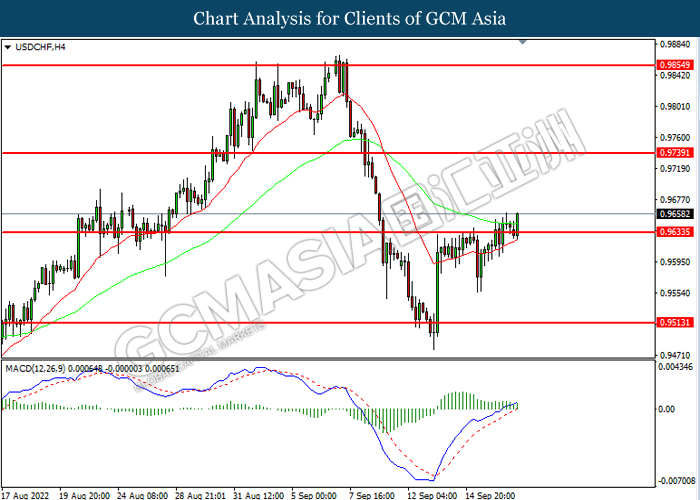

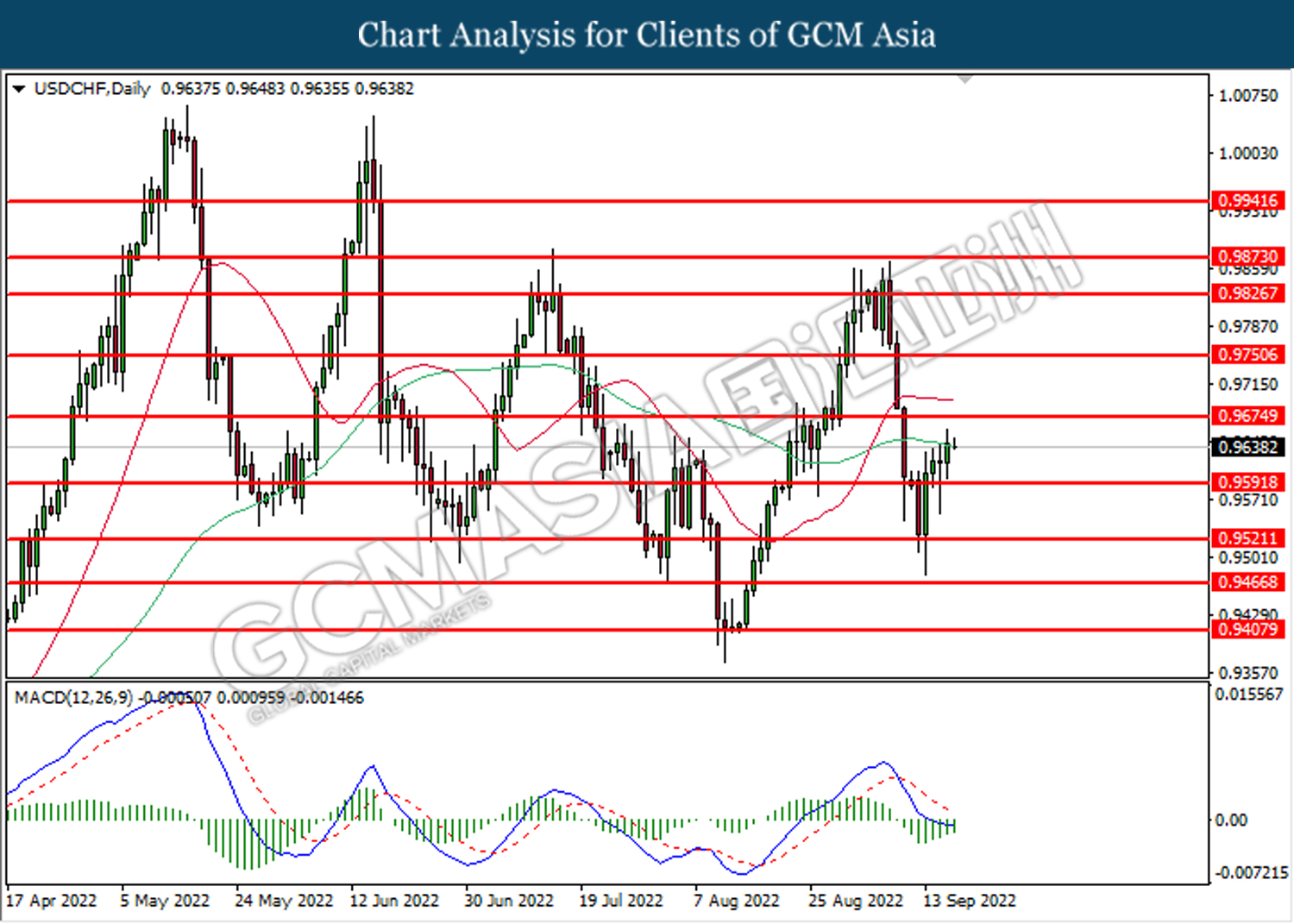

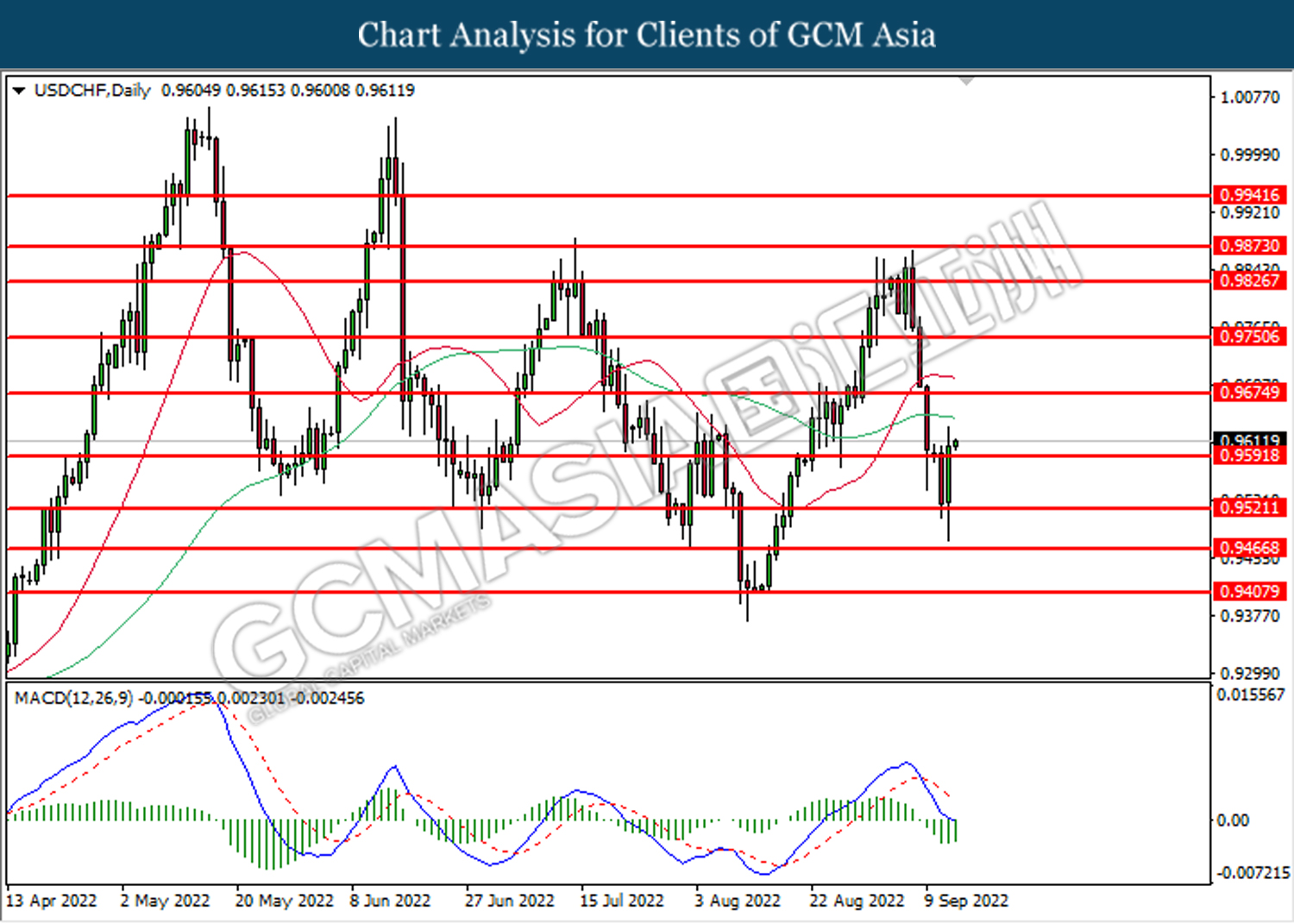

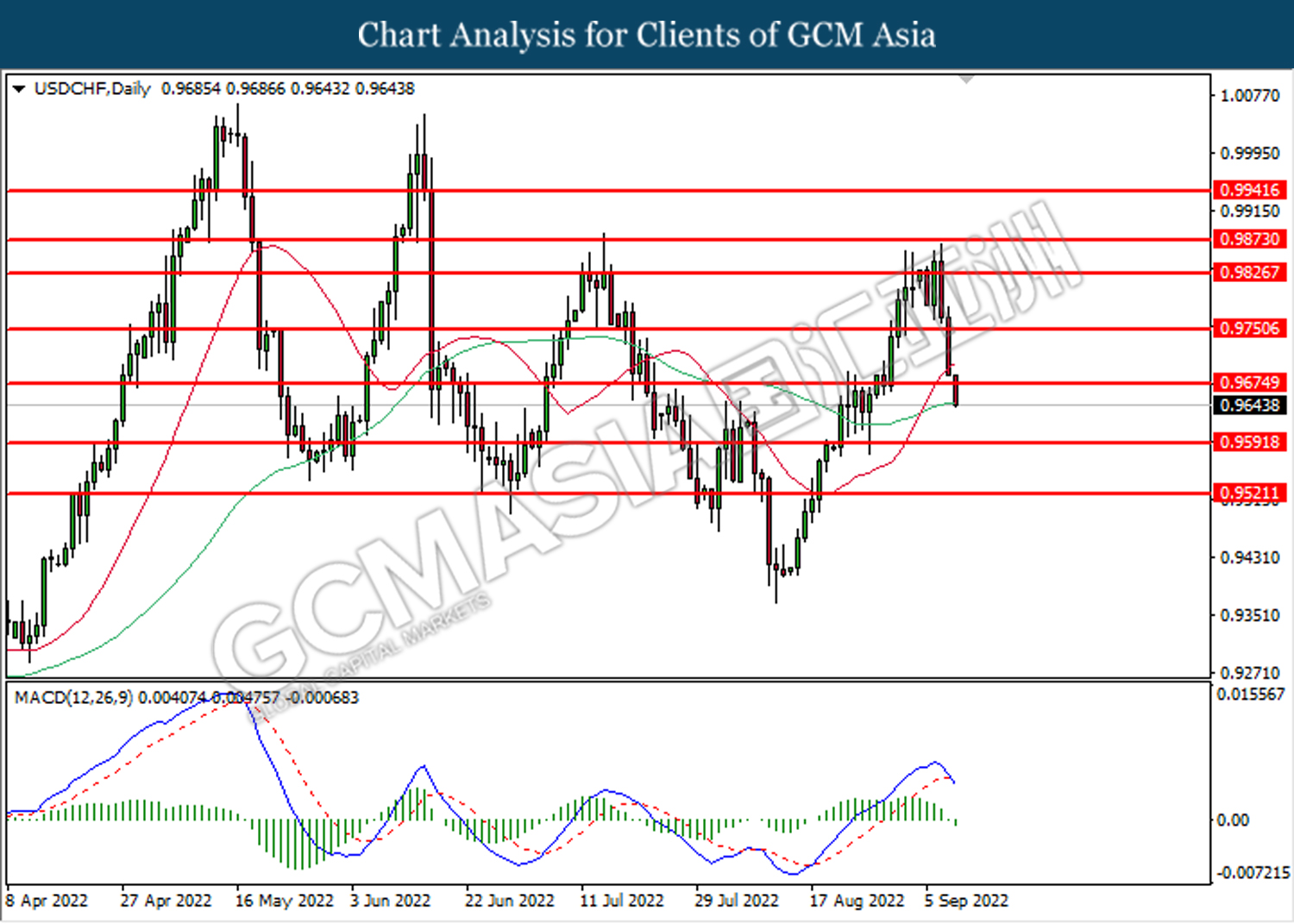

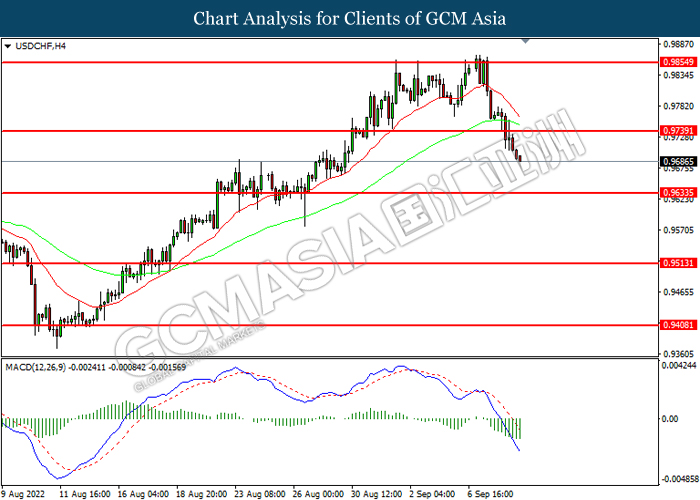

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

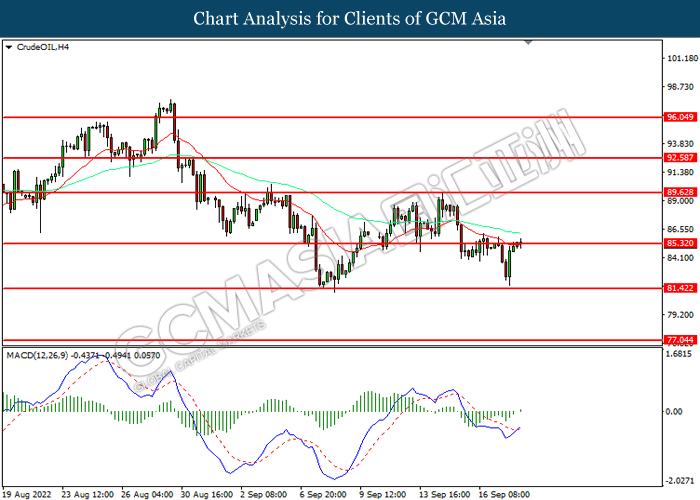

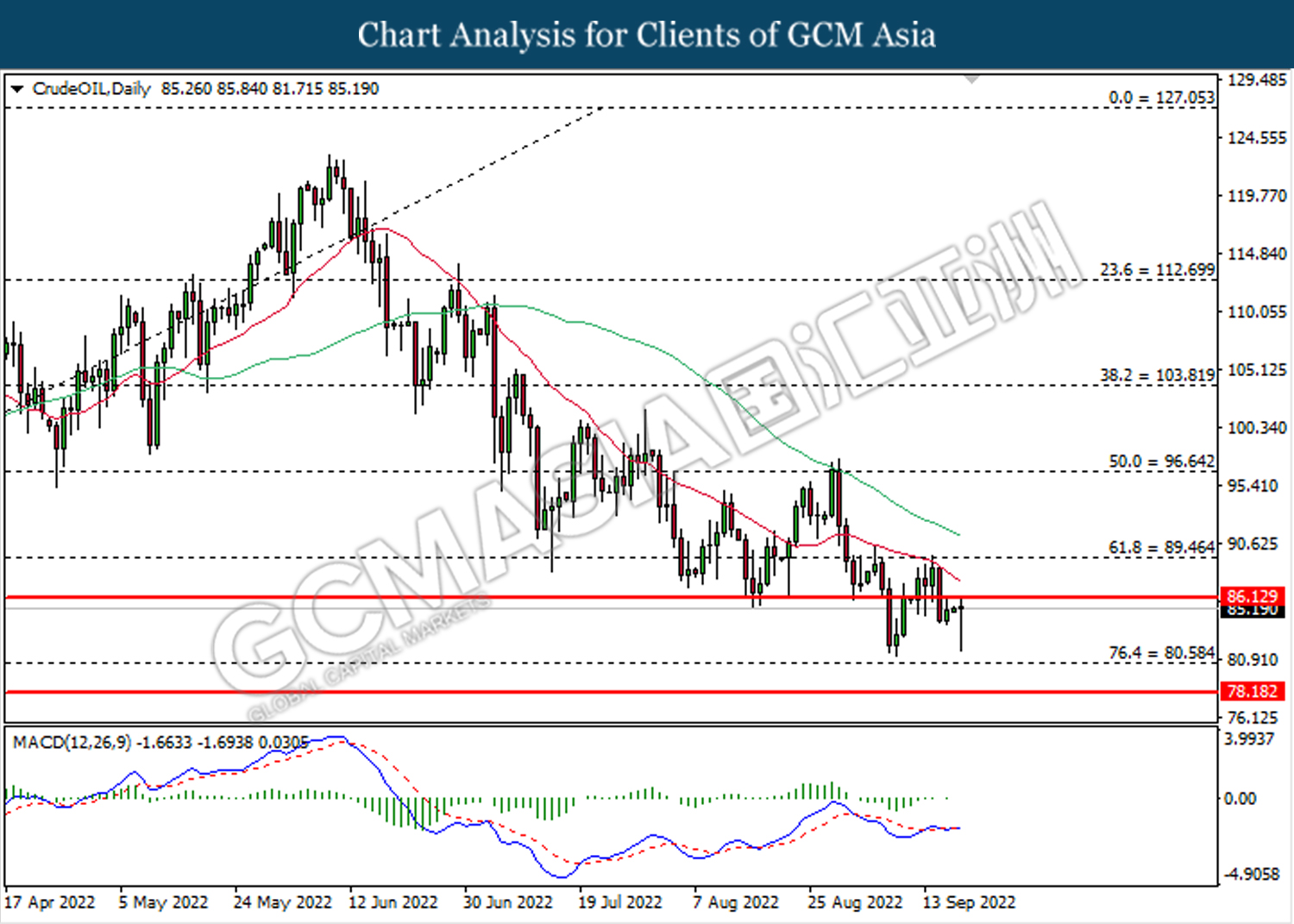

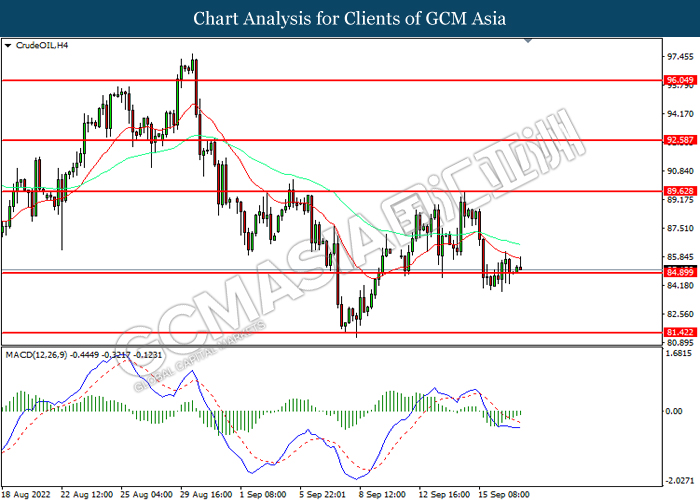

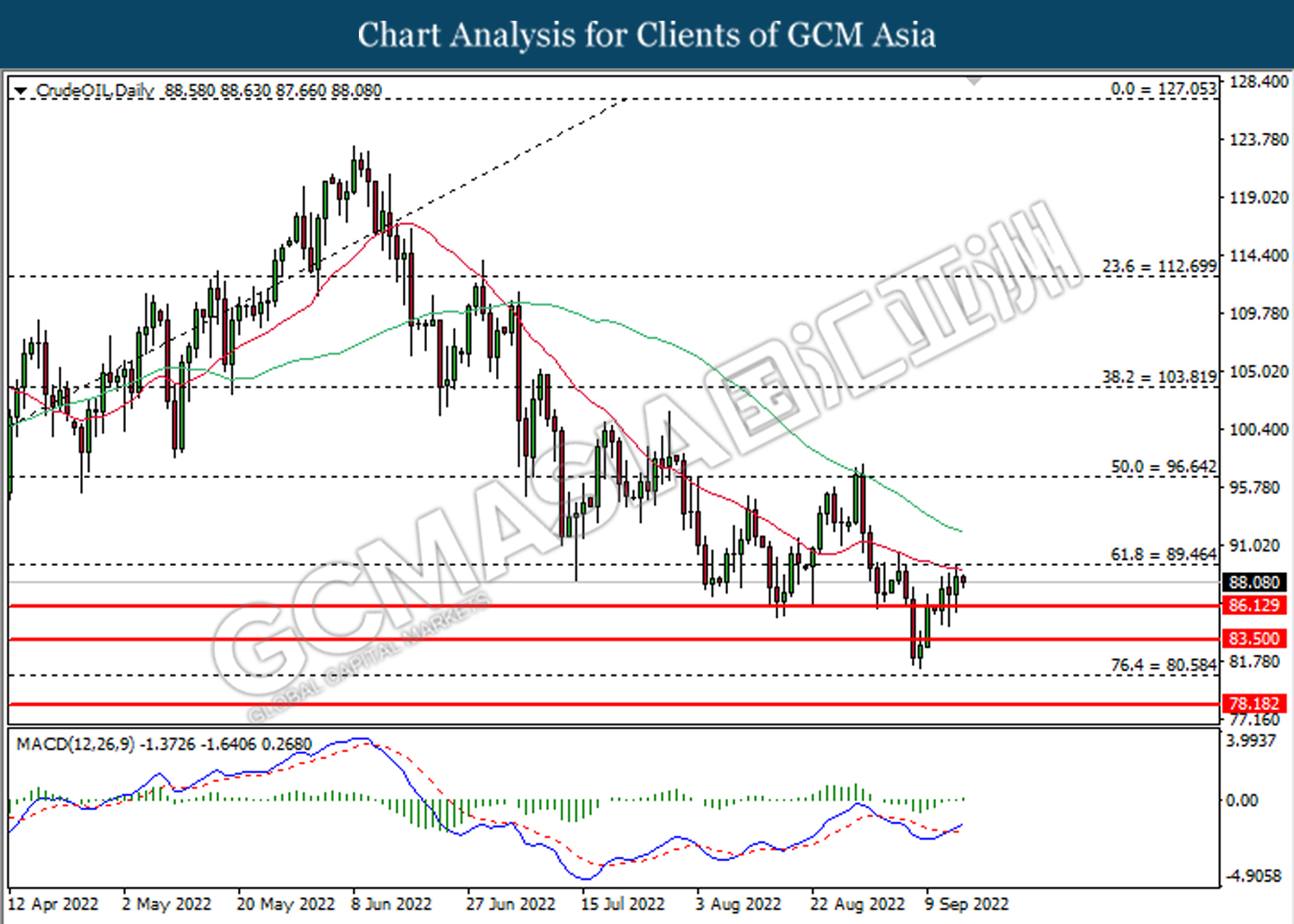

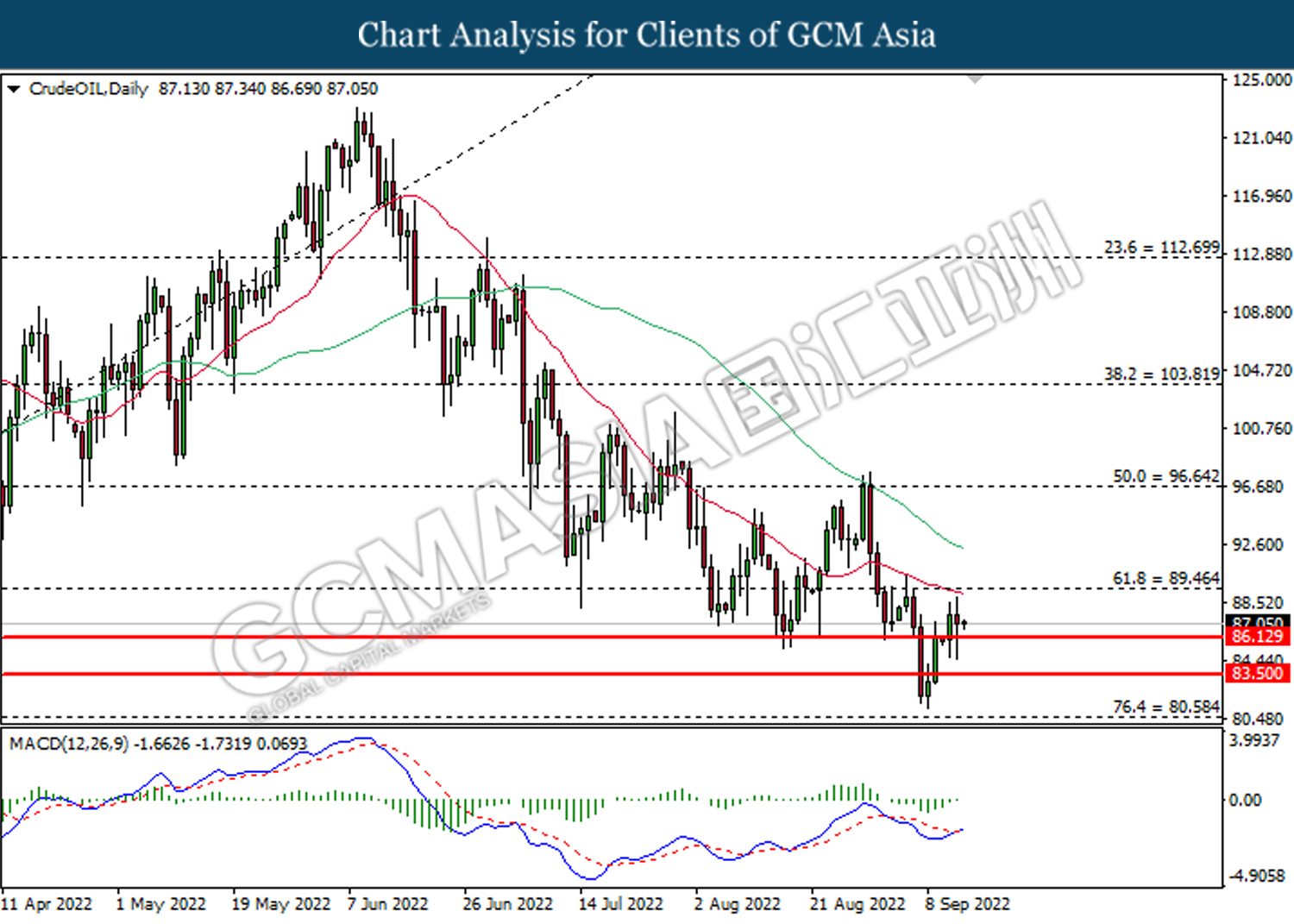

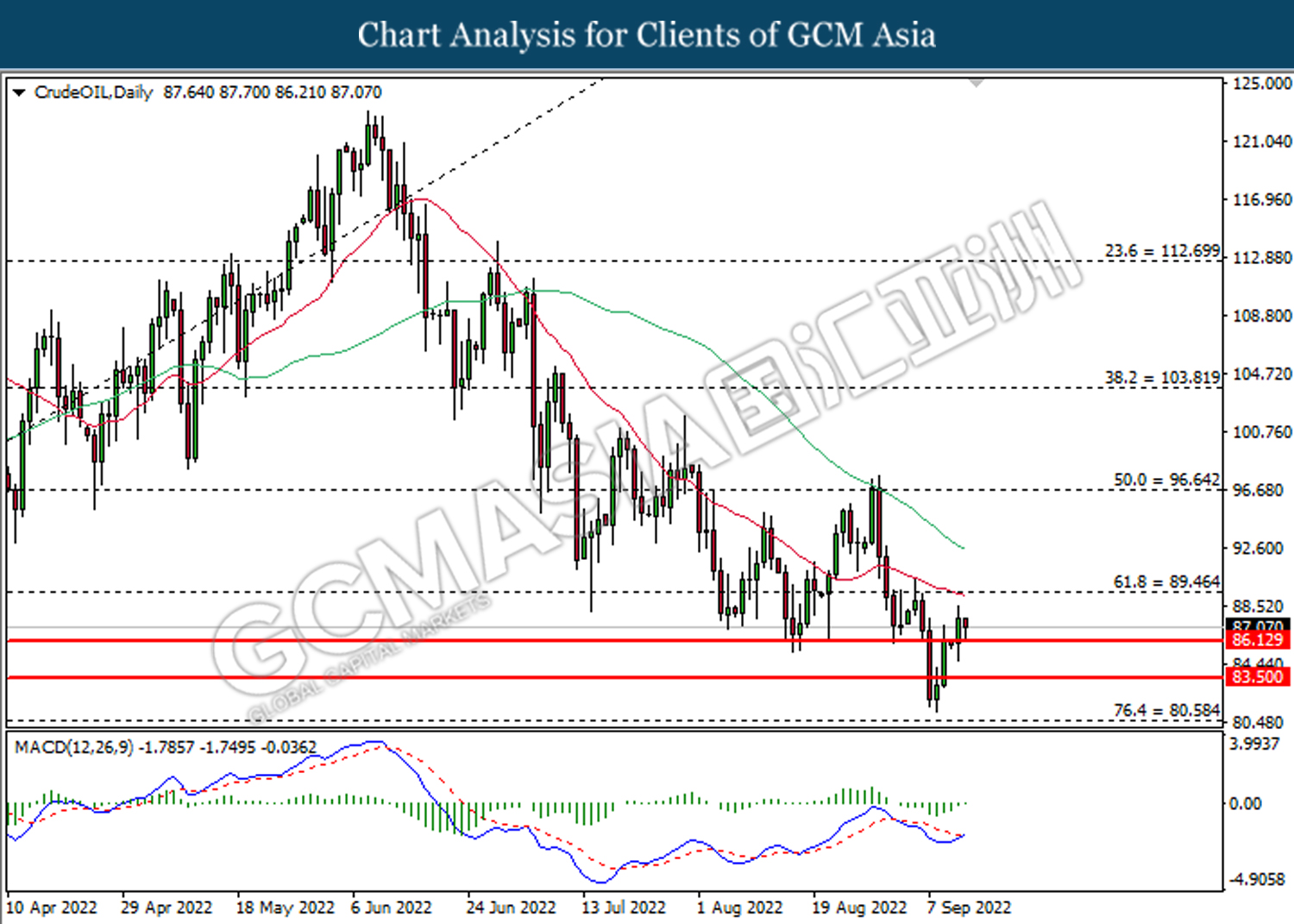

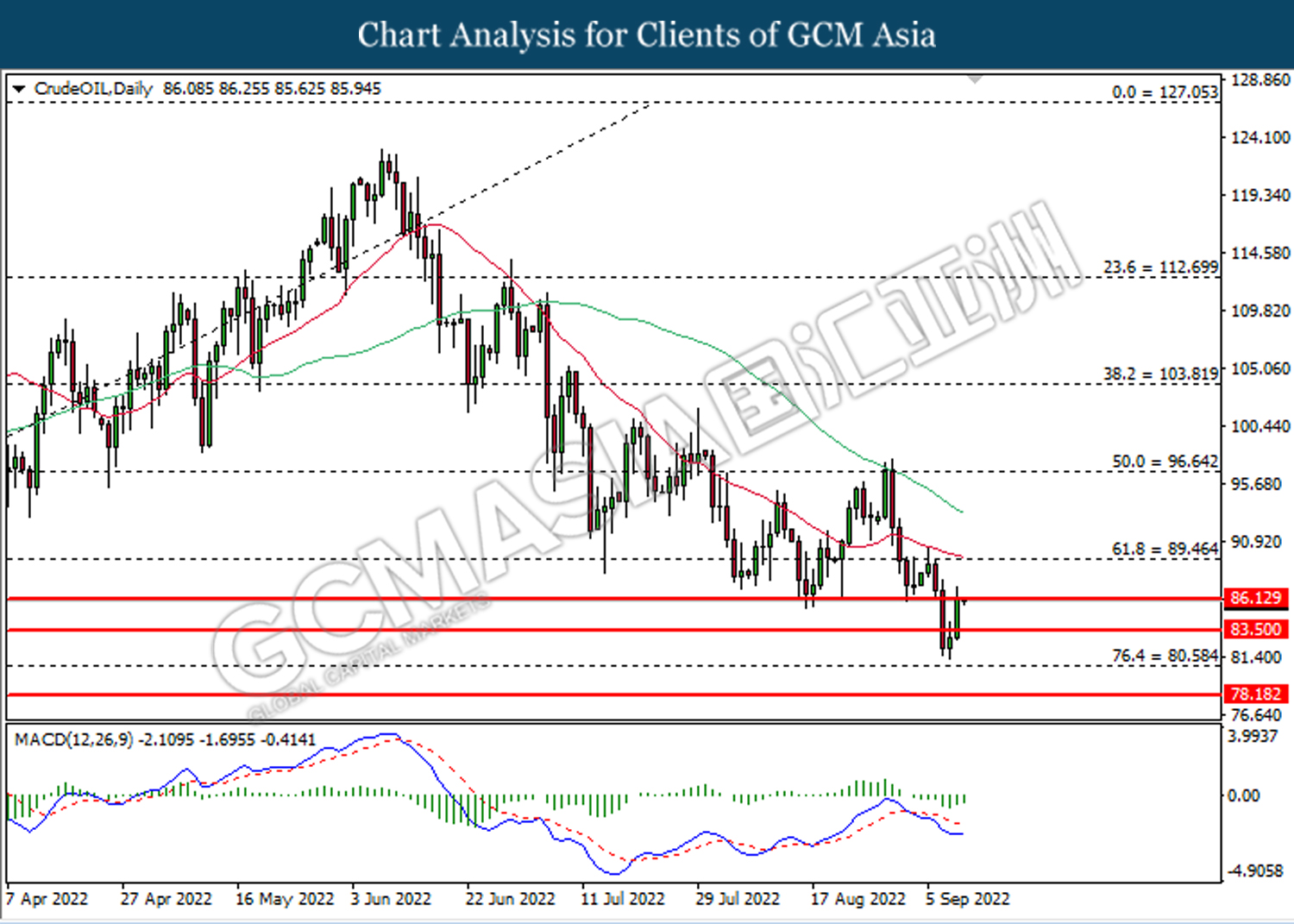

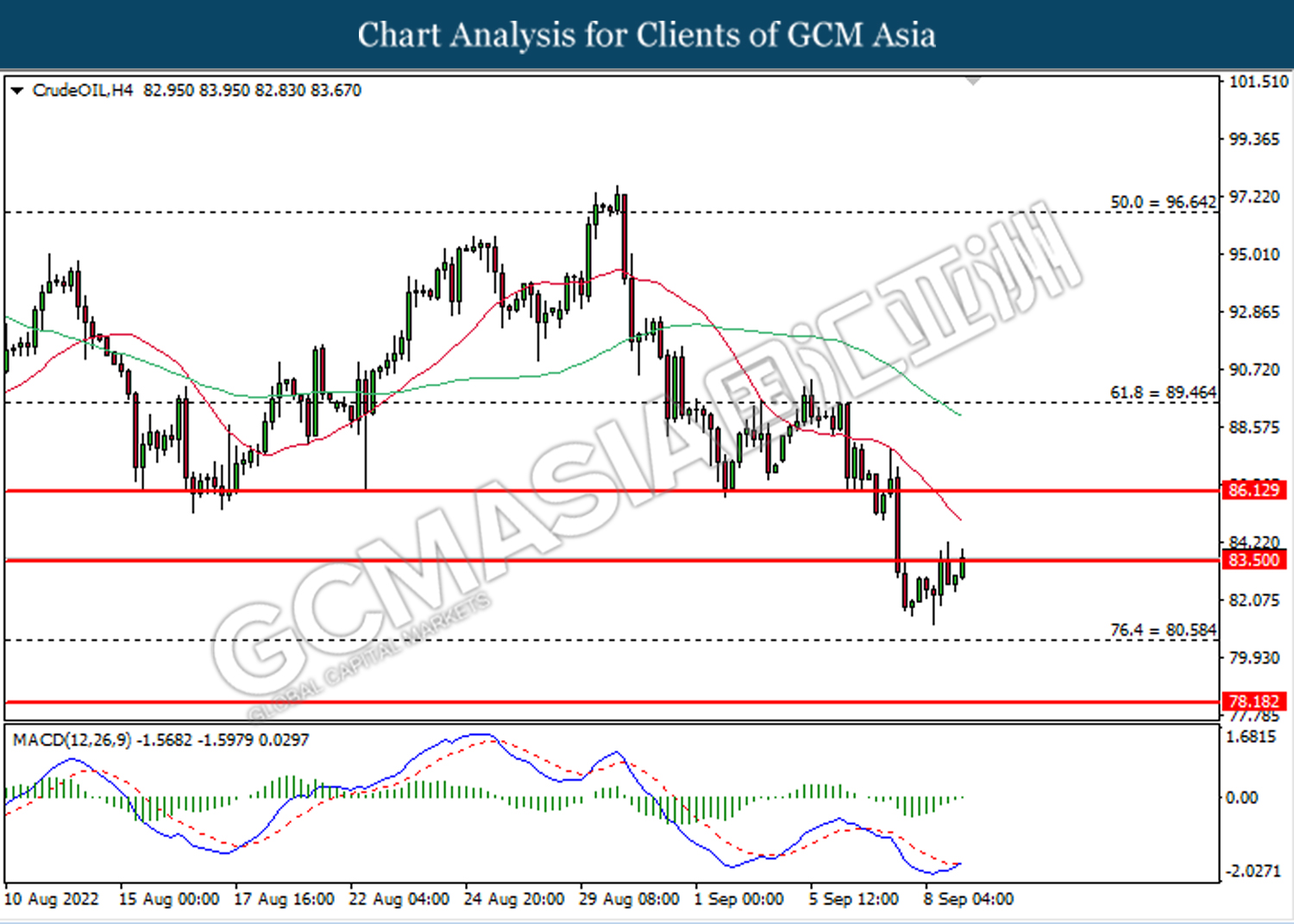

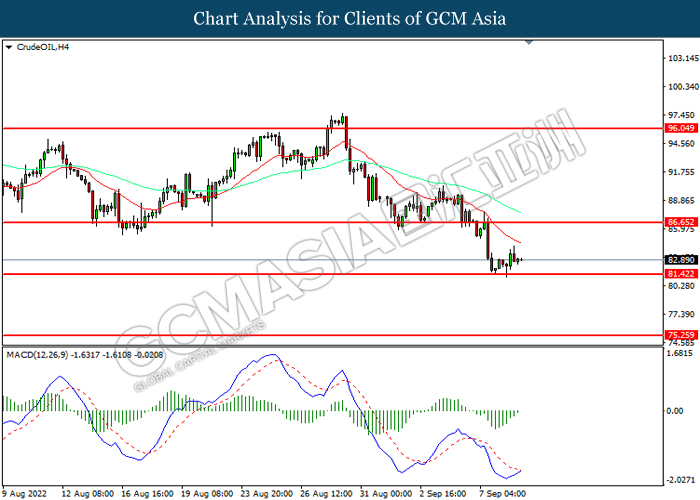

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 78.20

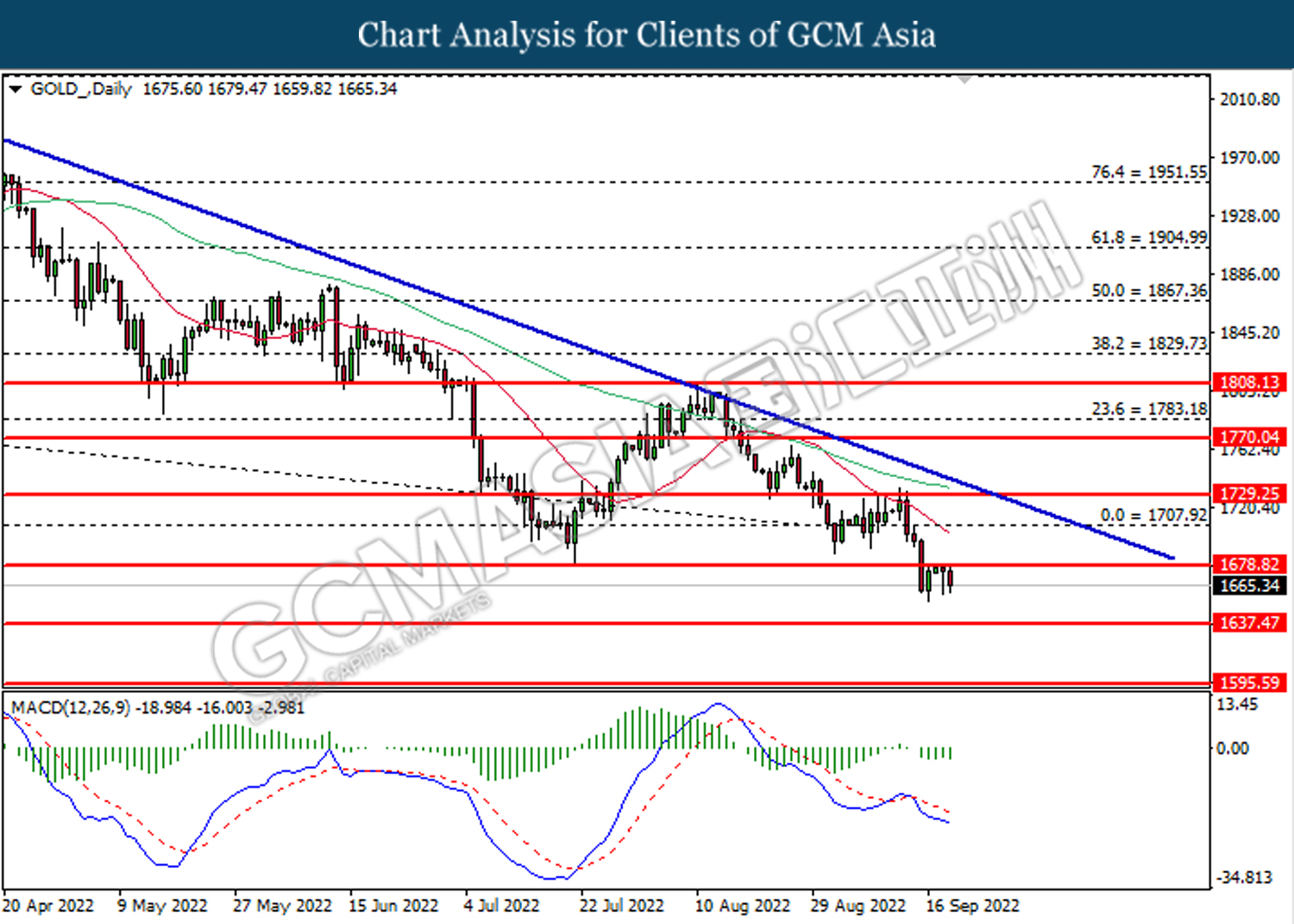

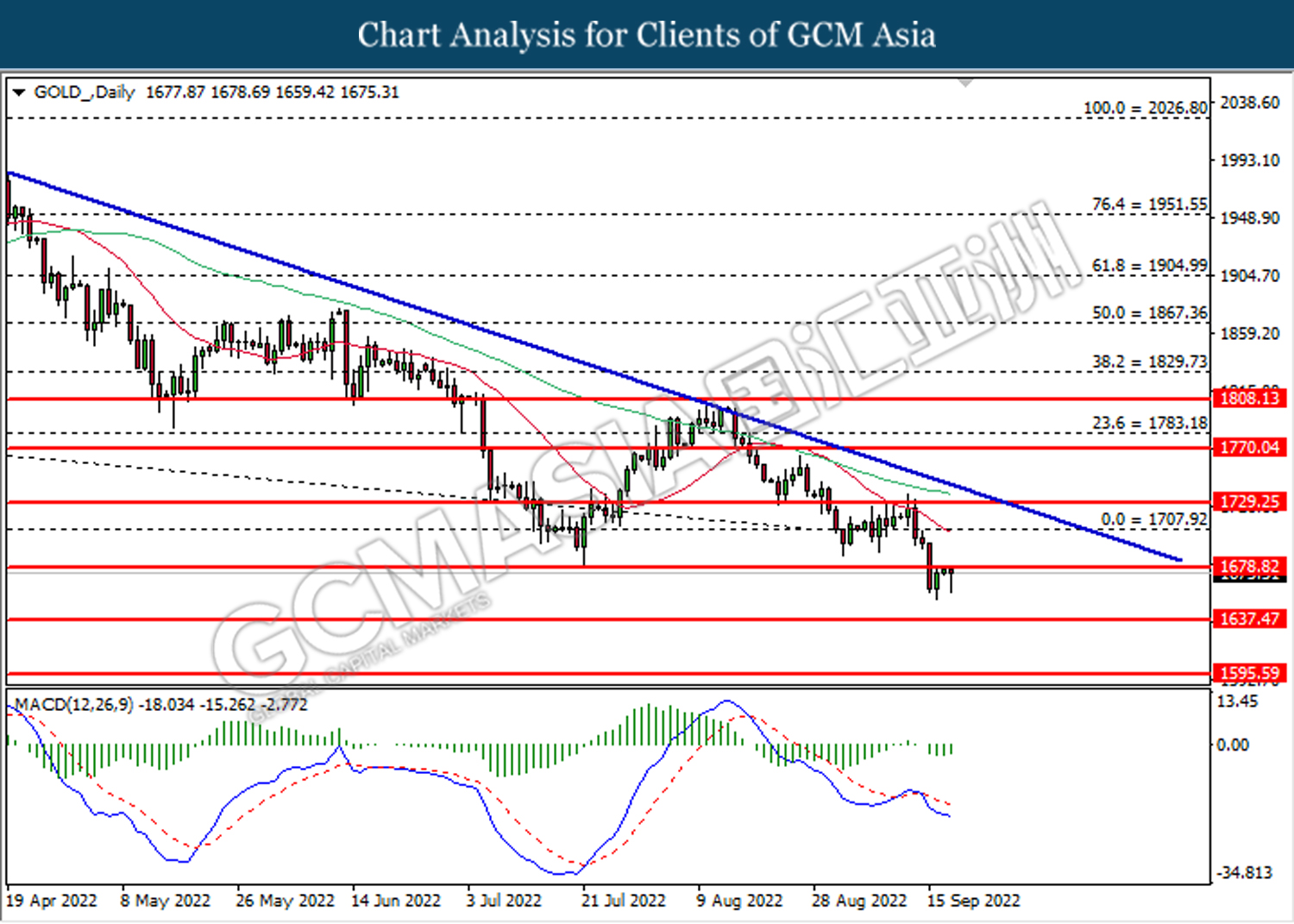

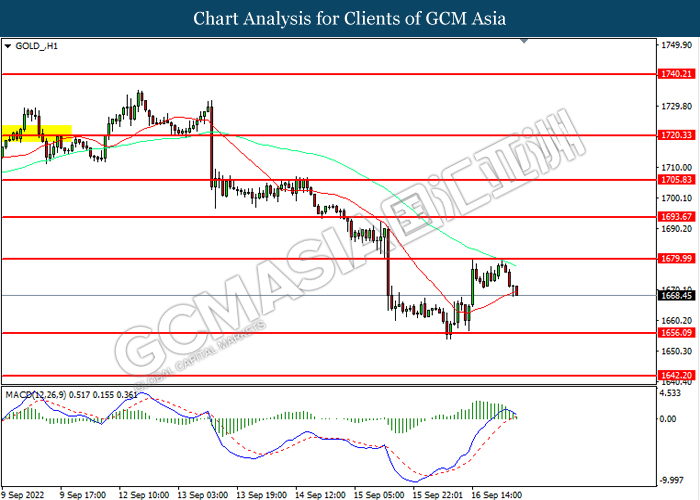

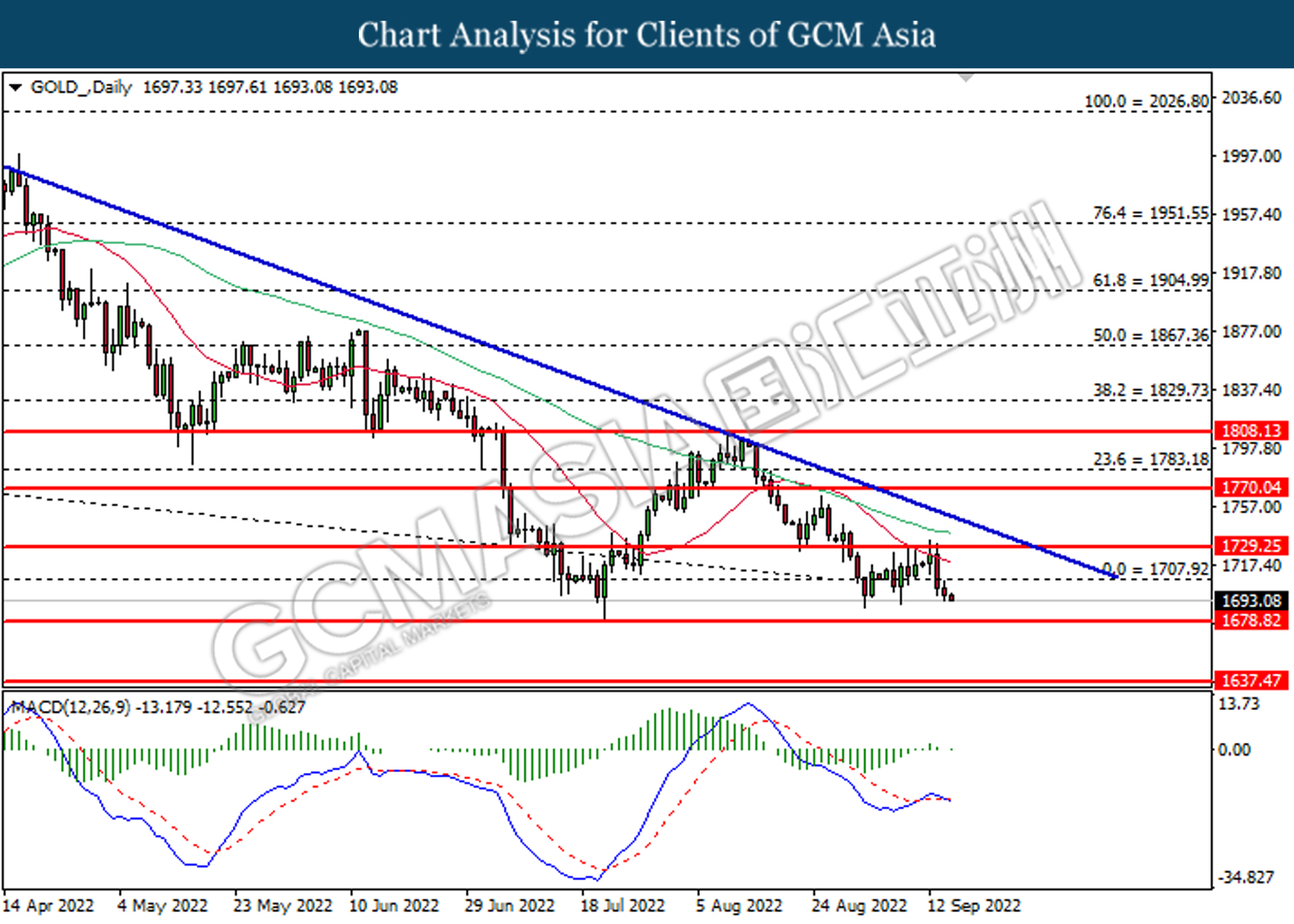

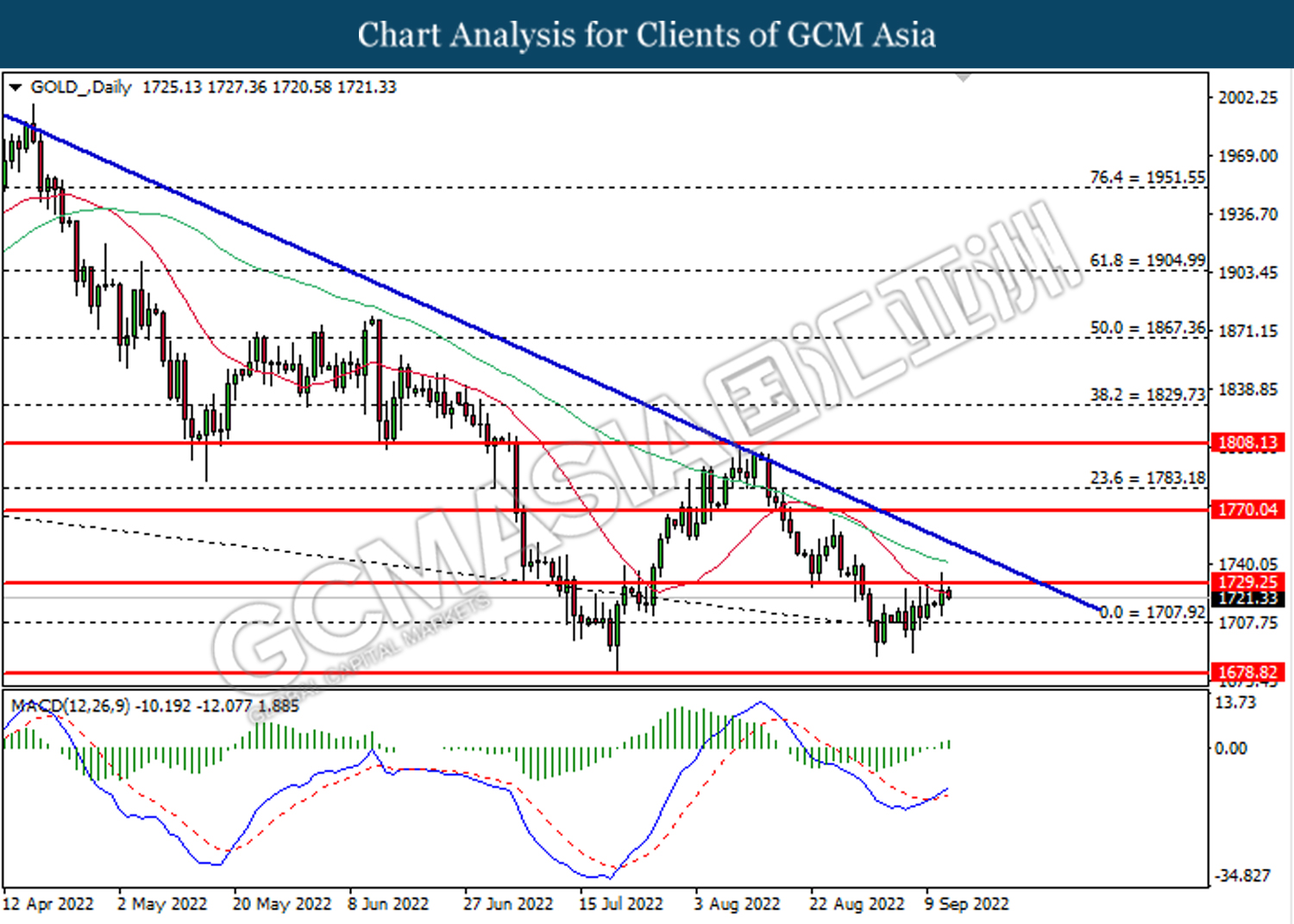

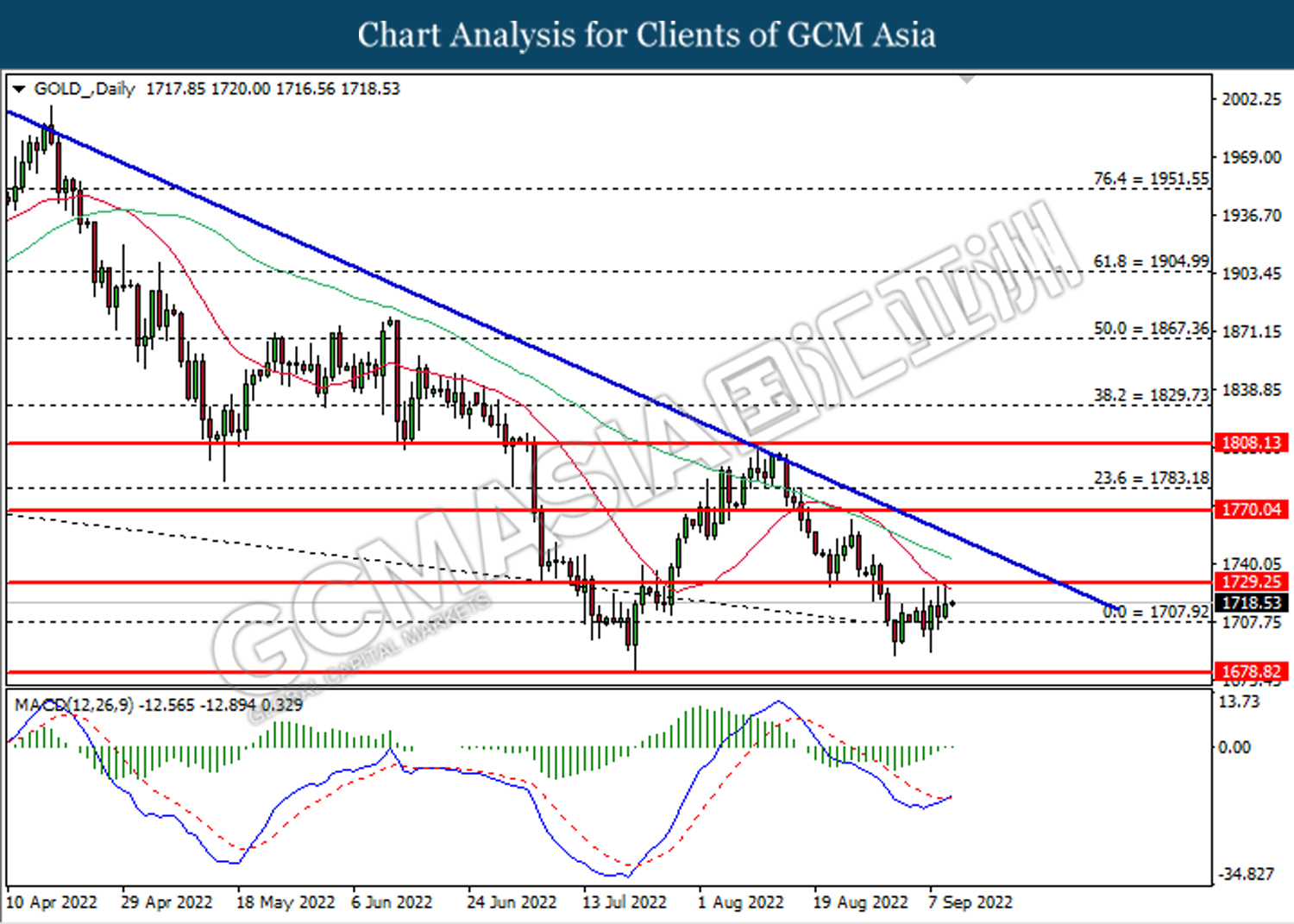

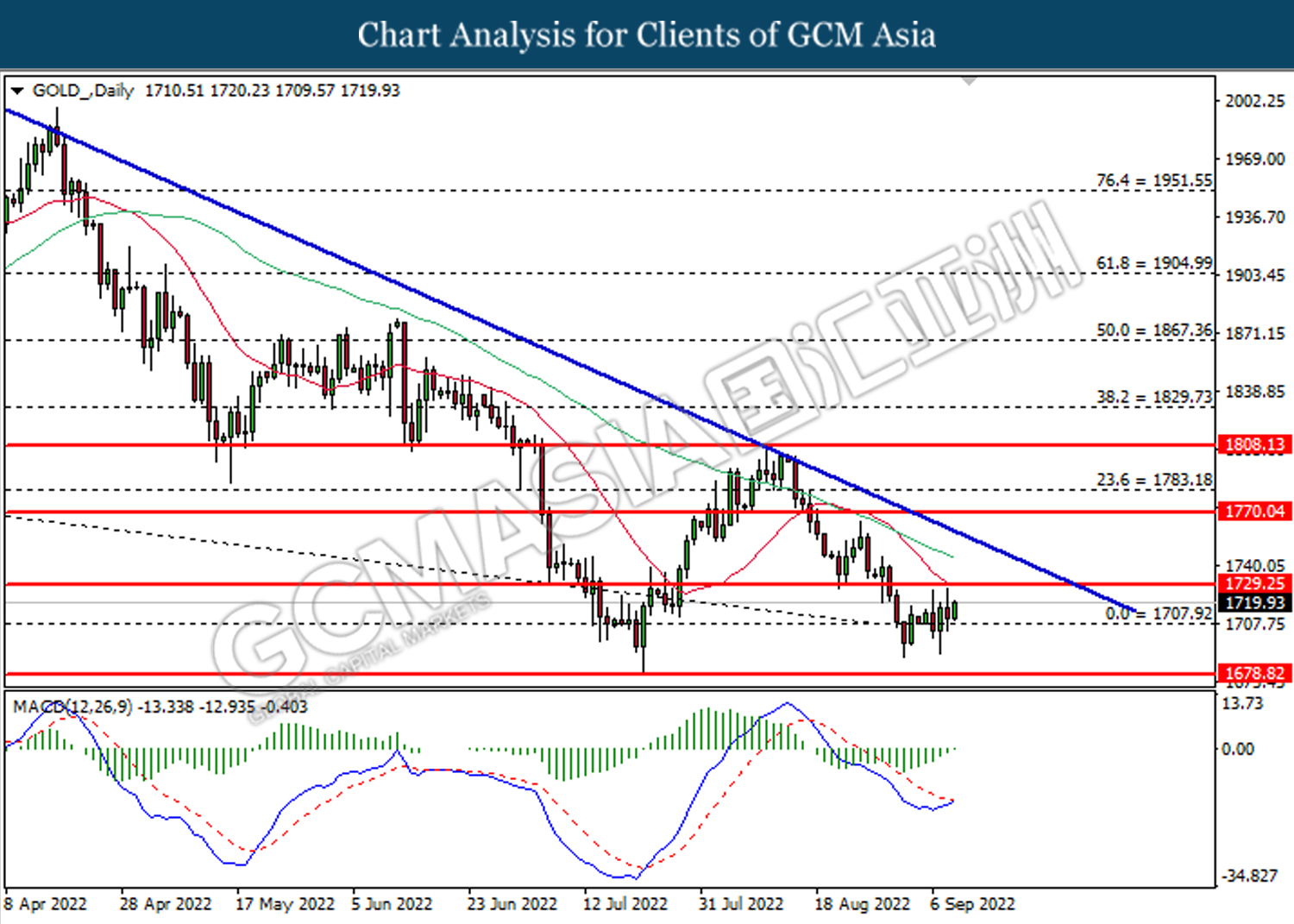

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1678.80. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1637.45.

Resistance level: 1678.80, 1707.90

Support level: 1637.45, 1595.60

200922 Afternoon Session Analysis

20 September 2022 Afternoon Session Analysis

Lockdown easing from China, sparked positive outlook toward Aussie.

The China proxy currency such as Australia Dollar rebounded from its lower level following Chinese authorities eased their Covid-19 lockdown in Chengdu. According to Reuters, the Chinese authorities claimed that the government departments, public transport services and companies were able to resume work on Monday, after shutting down on 1st September. The easing Covid-19 restriction would likely to spark positive prospect toward the China economy. Since China remained as Australia’s largest trading partner, the positive outlook for the Chinese economy would also enhance the demand for the Australia Dollar in future. On the other hand, the Japanese Yen is currently trading at 24-year lows, while the authorities have signaled to take action to stabilize the Japanese yen. Ahead of crucial Bank of Japan’s interest rate decision this week, investors would continue to scrutinize at whether Bank of Japan would shift from its current ultra-loose monetary policy. As of writing, AUD/USD appreciated by 0.01% to 0.6725 while USD/JPY depreciated by 0.07% to 143.10.

In the commodities market, the crude oil price surged 0.43% to $85.35 per barrel as of writing amid the easing of Covid-19 lockdown from Chinese authorities, which spurring bullish momentum on this black-commodity. On the other hand, the gold price depreciated by 0.03% to $1676.00 per troy ounces as of writing ahead of crucial FOMC meeting this week.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

01:00 EUR ECB President Lagarde Speaks

(21st Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Aug) | 1.685M | 1.610M | – |

| 20:30 | CAD – Core CPI (MoM) (Aug) | 0.5% | – | – |

Technical Analysis

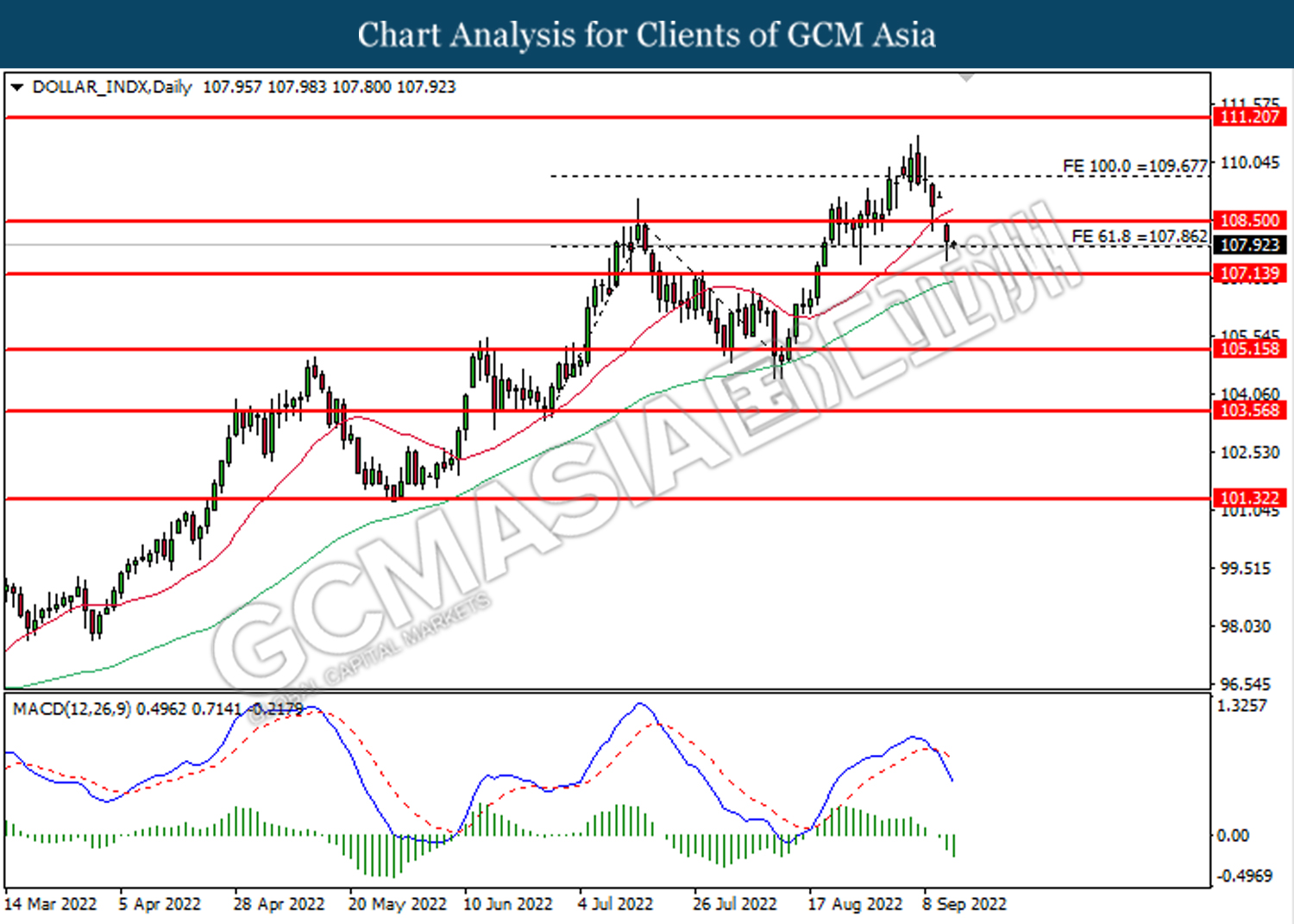

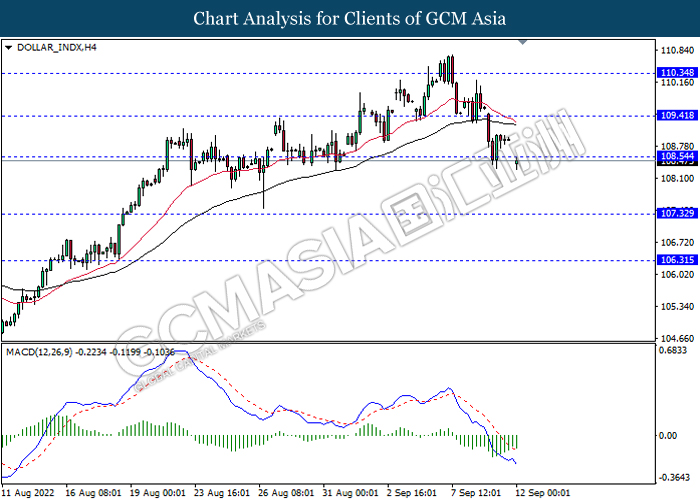

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

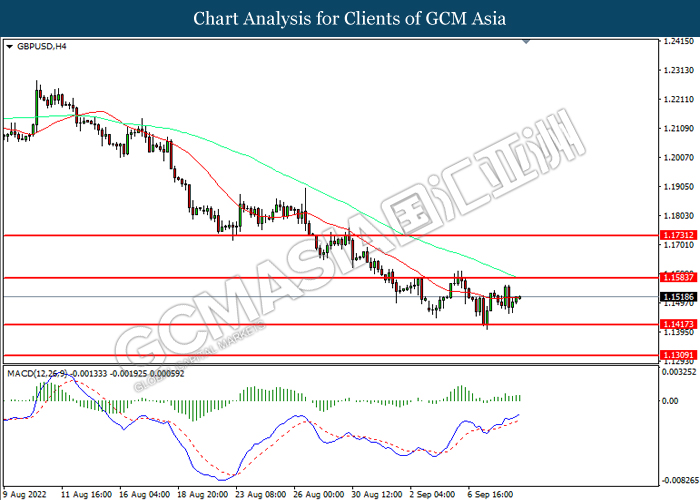

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1585, 1.1730

Support level: 1.1405, 1.1310

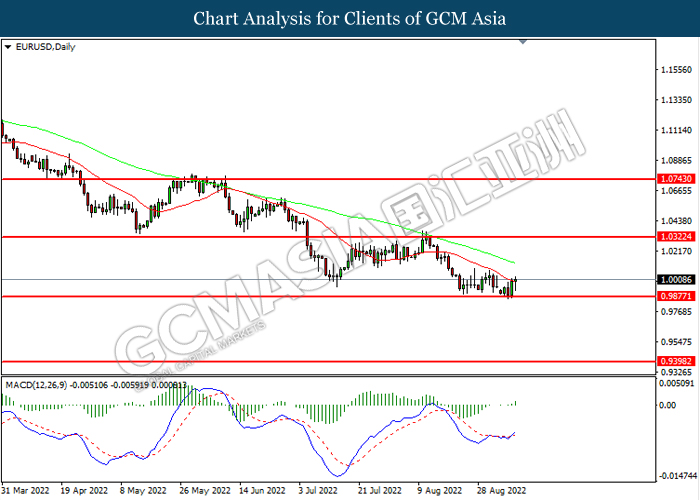

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0060, 1.0180

Support level: 0.9955, 0.9875

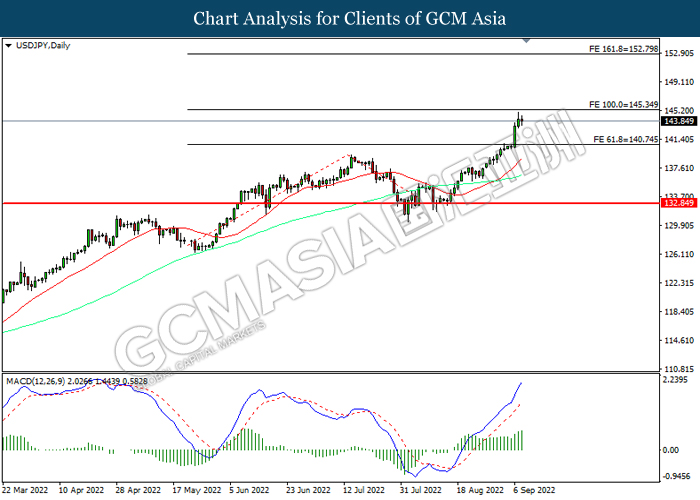

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

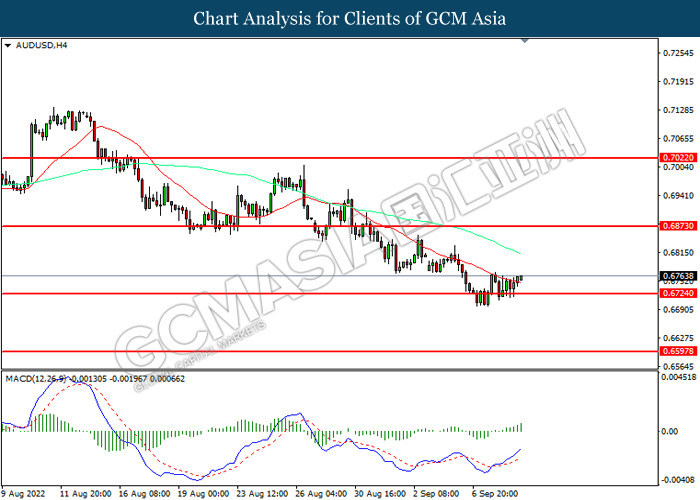

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7025

Support level: 0.6675, 0.6595

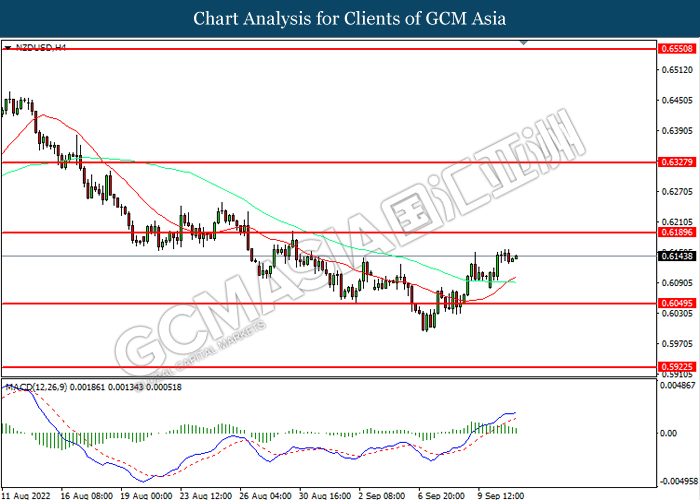

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6050, 0.6155

Support level: 0.5945, 0.5845

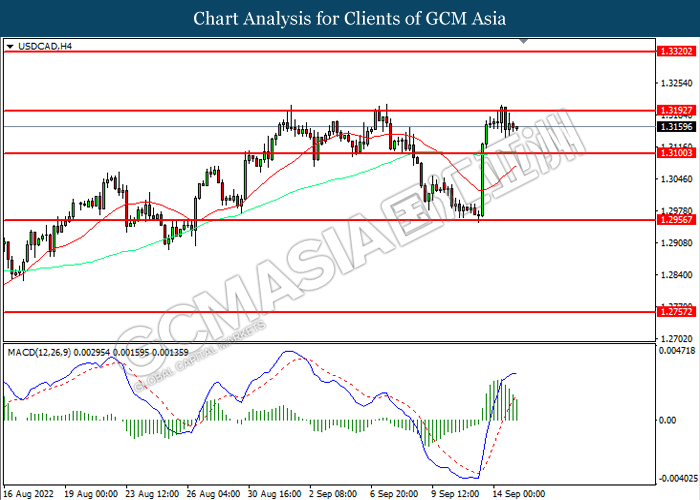

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3320, 1.3435

Support level: 1.3195, 1.3100

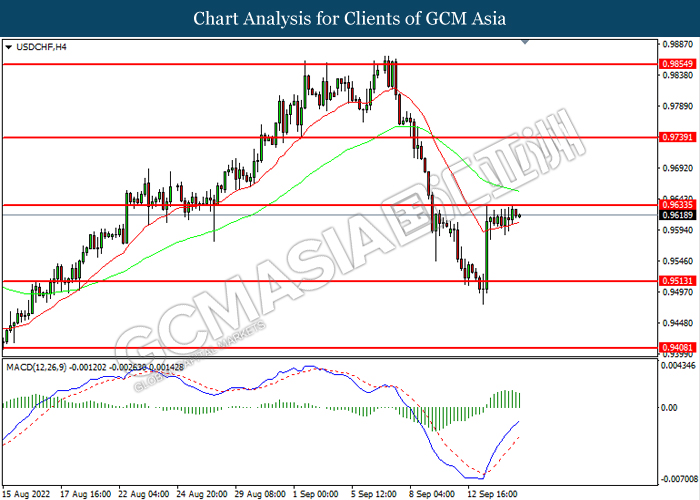

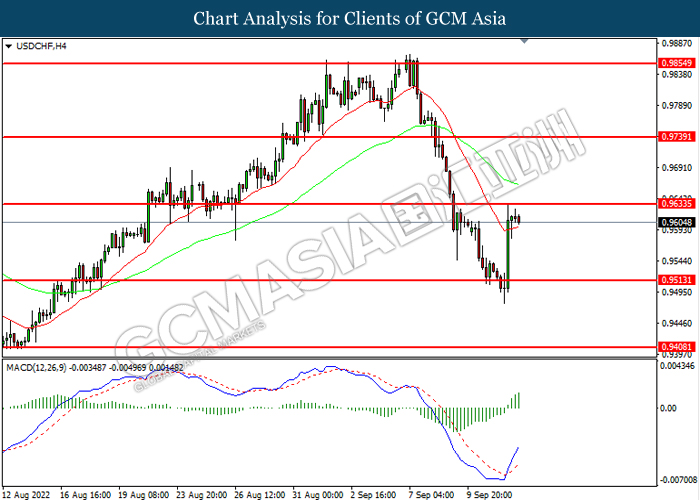

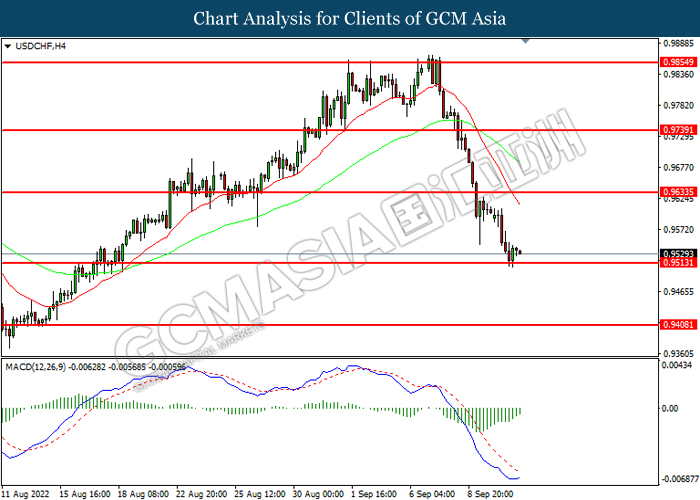

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

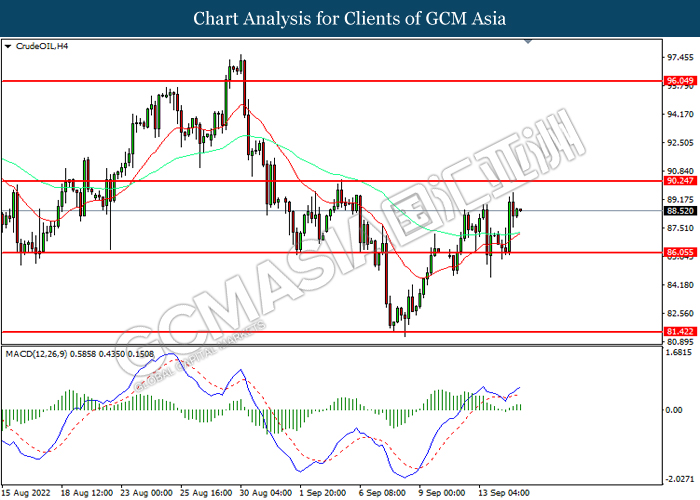

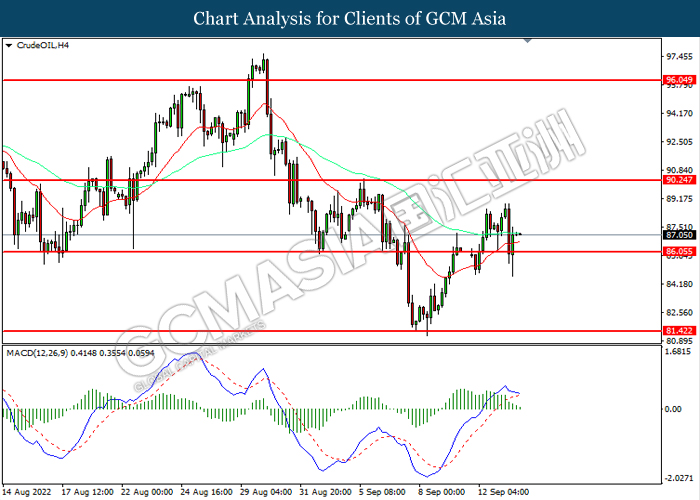

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 89.65, 92.60

Support level: 85.30, 81.40

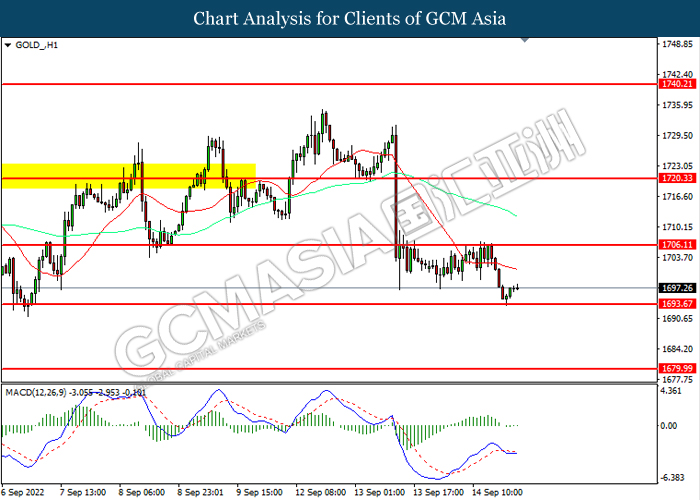

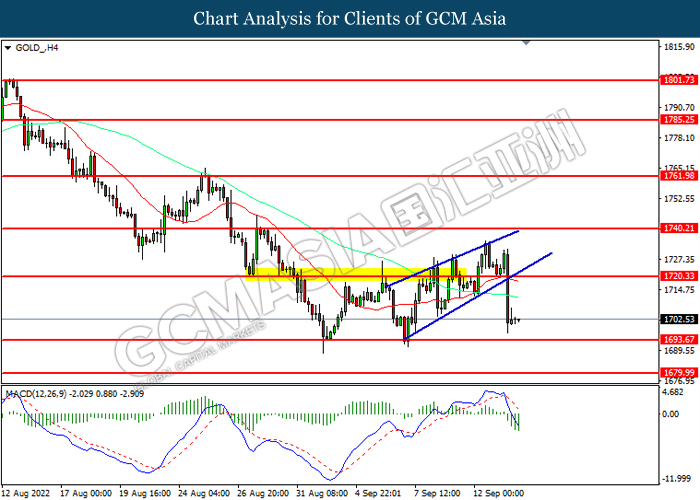

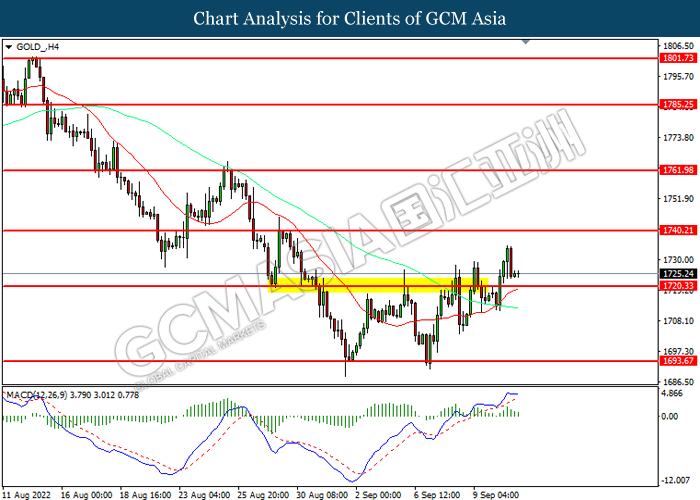

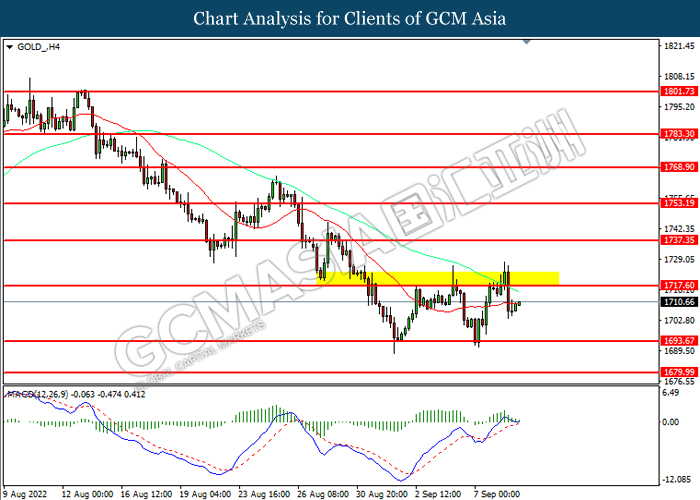

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20

200922 Morning Session Analysis

20 September 2022 Morning Session Analysis

Unstoppable bulls in dollar market.

The dollar index, which gauges its value against a basket of six major currencies, was traded within a tight range ahead of a slew of central bank meetings this week, where the Federal Reserve’s will be the main focus of the market participants. At this juncture, the investors reckon that the Federal Reserve is likely to raise the interest rates at least by another 75-basis point in the upcoming meeting. Besides, it is getting more and more market players are seeing the Federal Reserve has reason to go for a hefty rate hike, said 100 basis point, whereby the recent economic data showed resilience in the US economy. With that, the bull in dollar market is unlikely to be topped in anytime soon. The Federal Reserve will hold a two days meeting starting from Wednesday, where the final decision of the interest rate adjustment would be announced on early Thursday, accompanied by some projections of inflation, economic growth and future path of interest rates from the Fed. As of writing, the dollar index dropped -0.16% to 109.60.

In the commodities market, the crude oil price rose by 0.25% to $85.75 per barrel after an internal document showed that the OPEC+ fell short from the oil production plan, outweighing the fears of slowing demand and hefty rate hikes. Besides, the gold prices appreciated by 0.10% to $1675.35 per troy ounce after the dollar index retreated from the recent high level.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

01:00 EUR ECB President Lagarde Speaks

(21st Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Aug) | 1.685M | 1.610M | – |

| 20:30 | CAD – Core CPI (MoM) (Aug) | 0.5% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1455. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1350.

Resistance level: 1.1455, 1.1620

Support level: 1.1350, 1.1200

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0075.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

USDJPY, Daily: USDJPY was traded lower following prior retracement from the higher level. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5925.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

USDCAD, Daily: USDCAD was traded higher following prior retracement from the resistance level at 1.3320. MACD which illustrated diminishing bullish momentum suggests the pair to extend losses toward the support level at 1.3220.

Resistance level: 1.3320, 1.3385

Support level: 1.3220, 1.3140

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded higher while currently testing near the resistance level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 86.15, 89.45

Support level: 80.60, 78.20

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1678.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1678.80, 1707.90

Support level: 1637.45, 1595.60

190922 Afternoon Session Analysis

19 September 2022 Afternoon Session Analysis

Pound dipped as downbeat economic data sparked recession risk.

The Pound Sterling slumped significantly last week as the downbeat economic data had sparked recession fears, which dragging down the appeal for the Pound Sterling. According to Office for National Statistics, UK Retail sales for last month down significantly from the previous reading of 0.4% to -1.6%, missing the market forecast at -0.5%. With average UK wages continuing to fall behind rising prices and higher borrowing cost, the market participants remained pessimistic toward the economic progression in United Kingdom. In addition, the World Bank warned that the global financial market may be edging toward a global recession following the aggressive rate hike expectation from central bank, which stoked a shift in sentiment toward other safe-haven asset such as US Dollar, triggering further selloff for the Pound Sterling. Nonetheless, investors would be on high alert on monetary policy decision from Bank of England on Thursday to receive trading signal. The UK Policymakers are expected to increase their interest rate by another 50-basis point to stabilize the inflation risk. As of writing, GBP/USD depreciated by 0.09% to 1.1403.

In the commodities market, the crude oil price depreciated by 0.20% to $85.15 per barrel as of writing. The oil market edged lower as rising global recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold price depreciated by 0.36% to $1669.00 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day JPY Respect for the Aged Day

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1585, 1.1730

Support level: 1.1405, 1.1310

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0060, 1.0180

Support level: 0.9955, 0.9875

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.6980

Support level: 0.6705, 0.6595

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6050, 0.6155

Support level: 0.5945, 0.5845

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3320, 1.3435

Support level: 1.3195, 1.3100

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.65, 92.60

Support level: 84.90, 81.40

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20

190922 Morning Session Analysis

19 September 2022 Morning Session Analysis

Dollar remains elevated ahead of Fed Meeting.

The dollar index, which gauges its value against a basket of six major currencies, hovered near the recent high level as the investors are expecting the Federal Reserve to hike the interest rate aggressively in the upcoming meeting. Last Thursday, US Retail Sales data for the month of August came in at 0.3%, slightly higher than the consensus forecast of 0.2%, showing resilience in face of inflation. The gains, in fact, has outpaced the inflation and marked a reversal from July -0.4% decline, whereby the consumer spending increased at a steady pace over the month. Nonetheless, market participants are waiting for the Federal Reserve rate hike decision on 22th September before restructuring their investment portfolio. At this point in time, the investors are widely expecting the Federal Reserve will increase at least 75-basis point, while a 100-basis point rate hike is also on the table. Hence, the dollar is expected to continue supported by the view that Fed will keep the tightening policy aggressively going forward. As of writing, the dollar index inched down -0.11% to 109.65.

In the commodities market, the crude oil price rose by 0.40% to $85.35 per barrel but remained down amid the fears that hefty rate hike will dampen the global demand in the future. Besides, the gold prices appreciated by 0.20% to $1678.70 per troy ounce as the dollar index weakened.

Today’s Holiday Market Close

Time Market Event

All Day JPY Respect for the Aged Day

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1455. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1350.

Resistance level: 1.1455, 1.1620

Support level: 1.1350, 1.1200

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0000. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

USDJPY, Daily: USDJPY was traded lower following prior retracement from the higher level. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5925. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6030.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3220. MACD which illustrated bullish bias momentum suggests the pair to extend gains toward the resistance level at 1.3320.

Resistance level: 1.3320, 1.3385

Support level: 1.3220, 1.3140

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded higher while currently testing near the resistance level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 86.15, 89.45

Support level: 83.50, 80.60

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1678.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1678.80, 1707.90

Support level: 1637.45, 1595.60

150922 Afternoon Session Analysis

15 September 2022 Afternoon Session Analysis

New Zealand GDP beats expectation.

The New Zealand dollar rebounded sharply early morning as upbeat economic data spurred optimism in the currency market. According to Statistics New Zealand, the nation’s economy expanded by 1.7% in the second quarter of 2022, reviving from a -0.2% fall in the prior quarter, as the lifting of the Covid-19 restriction rebooted the New Zealand economy. However, the recovery was largely in line with the economist’s expectations, where the economy was expected to recover strongly following two consecutive quarters of recession amid the reignition of Covid-19 cases and rising commodity prices. With such a backdrop, it provides ample room for the Reserve Bank of New Zealand (RBNZ) to further tighten the monetary policy, curbing the sky-high inflationary pressures in the country. Last year, the RBNZ was among the first central banks in the world to increase their cash rate. As of writing, the pair of NZD/USD up 0.20% to 0.6015.

In the commodities market, the crude oil price plunged -by 0.44% to $88.10 per barrel on the prospect of rising interest rates in the US. Besides, the gold prices depreciated by -0.16% to $1695.00 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Aug) | 0.40% | 0.20% | – |

| 20:30 | USD – Initial Jobless Claims | 222K | 225K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Sep) | 6.2 | 3.5 | – |

| 20:30 | USD – Retail Sales (MoM) (Aug) | 0.00% | 0.20% |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1455.

Resistance level: 1.1620, 1.1770

Support level: 1.1455, 1.1350

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9910.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 141.50. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6030. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5925.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3140. MACD which illustrated diminishing bearish momentum suggests the pair to extend gains toward the resistance level at 1.3220.

Resistance level: 1.3220, 1.3320

Support level: 1.3140, 1.3050

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 96.65

Support level: 86.15, 83.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1707.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1678.80.

Resistance level: 1707.90, 1729.25

Support level: 1678.80, 1637.45

150922 Morning Session Analysis

15 September 2022 Morning Session Analysis

Expectation upon currency intervention from BoJ, Yen rebounded.

The Japanese Yen started to rebound from the 24-year low overnight amid expectation upon the currency intervention from Bank of Japan. According to Reuters, the Bank of Japan could conduct a rate check with banks in apparent preparation to stabilize the recent depreciation from Japanese Yen. Though, Finance Minister Shunichi Suzuki claimed that the authorities would make no advance announcement of plans to intervene, heightens uncertainty for firms and traders in making business decisions. Though, investors would still continue to scrutinize the latest updates from the Bank of Japan to receive further trading signal. Recently, the Japanese Yen has depreciated nearly 30% this year following the Bank of Japan (BoJ) continue to maintain its ultra-loose monetary policy, in contrast with its global peers. As of writing, the pair of USD/JPY slumped 0.14% to 142.95.

In the commodities market, the crude oil price extends its gains amid investors speculated that the manufacturing firm would start to substitute the natural gas into crude oil following Russia restrict natural gas supply into European region. On the other hand, the gold price extends its losses by 0.01% to $1697.55 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Aug) | 0.40% | 0.20% | – |

| 20:30 | USD – Initial Jobless Claims | 222K | 225K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Sep) | 6.2 | 3.5 | – |

| 20:30 | USD – Retail Sales (MoM) (Aug) | 0.00% | 0.20% |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0075, 1.0190

Support level: 0.9875, 0.9775

USDJPY, H1: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 143.15, 144.20

Support level: 142.00, 140.75

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6150, 0.6230

Support level: 0.6000, 0.5935

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3195, 1.3320

Support level: 1.3100, 1.2955

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 90.25, 96.05

Support level: 86.05, 81.40

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1706.10, 1720.35

Support level: 1693.65, 1680.00

140922 Afternoon Session Analysis

14 September 2022 Afternoon Session Analysis

Pound stunned ahead of long-awaited CPI data.

The Sterling Pound, which was majorly traded by global investors, experienced huge buy in pressures as hotter-than-expected CPI data was released in the US yesterday. Following the release of the CPI data, it hurt the market sentiment as market were expecting the price of goods and services was to start falling, seeing economy to cool down in near-term. As such, the pair of GBP/USD plunged tremendously, heading toward the recent low level again. Going forward, the market participants are eyeing on the upcoming crucial data – Consumer Price Index (CPI), which scheduled at 14:00 (GMT+8) today. Now, the investors are expecting the UK inflation figure will not cool down at the moment as BoE has already warned that it expects CPI to reach as high as 13% in October and the economy would enter into a recession for an extended period. Hence, the investors are waiting for the upcoming CPI data to gauge the further direction of the currency. As of writing, the pair of GBP/USD surged 0.14% to 1.1505.

In the commodities market, the crude oil price plunged -0.15% to $87.00 per barrel as the surge in the greenback value urged the non-US oil buyer to temporarily shy away from the black commodity market amid a more expensive price compared to usual. Besides, the gold prices depreciated by 0.04% to $1703.05 per troy ounce amid the stronger-than-expected CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Aug) | 10.10% | 10.20% | – |

| 20:30 | USD – PPI (MoM) (Aug) | -0.50% | -0.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.844M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1455.

Resistance level: 1.1620, 1.1770

Support level: 1.1455, 1.1350

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9910.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 141.50. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 146.50.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6030. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5925.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3140. MACD which illustrated diminishing bearish momentum suggests the pair to extend gains toward the resistance level at 1.3220.

Resistance level: 1.3220, 1.3320

Support level: 1.3140, 1.3050

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 89.45. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 89.45, 96.65

Support level: 86.15, 83.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1707.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1678.80.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

140922 Morning Session Analysis

14 September 2022 Morning Session Analysis

US Dollar surged as spiking inflation rate implies an aggressive rate hike decision.

The Dollar Index which traded against a basket of six major currencies rebounded significantly over the backdrop of surprising inflation data, prompting bets for more aggressive rate hike from Federal Reserve in future. According to US Bureau of Labor Statistics, US Core Consumer Price Index (CPI) for last month notched up significantly from the previous reading of 0.3% to 0.6%, exceeding the market forecast at 0.3%. The recent data had indicated that the inflation levels have continue to creep upward, coupled with the vast improvement in employment market in US on the back of strong economic growth would likely to cause the Federal Reserve to make a more hawkish tone during the FOMC meeting next week. Besides that, the safe-haven US Dollar extend its gains following the S&P 500 tumbled by more than 4%, which stoked a shift in sentiment toward the safe-haven US Dollar. Financial market is currently fully priced in an interest rate hike of at least 75 basis point during the FOMC meeting next week, with another 32% probability of 100 basis point rate hike, according to CME’s FedWatch Tool. As of writing, the Dollar Index appreciated by 1.55% to 109.56.

In the commodities market, the crude oil price slumped 0.08% to $87.05 per barrel as of writing. The oil market edged lower following the release of inventory data. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at 6.035M, higher than the market forecast at -0.200M. On the other hand, the gold price dipped significantly to $1700.05 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Aug) | 10.10% | 10.20% | – |

| 20:30 | USD – PPI (MoM) (Aug) | -0.50% | -0.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.844M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.0075, 1.0190

Support level: 0.9875, 0.9775

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 132.85

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6065, 0.6145

Support level: 0.5995, 0.5935

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3195, 1.3320

Support level: 1.3100, 1.2955

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 90.25, 96.05

Support level: 86.05, 81.40

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1720.35, 1740.20

Support level: 1693.65, 1680.00

130922 Afternoon Session Analysis

13 September 2022 Afternoon Session Analysis

Downbeat data weighed on Pound.

The Sterling Pound, which was majorly traded by global investors, experienced huge sell-off pressures after a series of downbeat data were released yesterday. According to the Office for National Statistics, the GDP for the month of July rose by 0.2%, weaker than the consensus forecast of 0.3%, amid the factors of worker shortages and heightening costs of living with the backdrop of heightened recession risk. Prior to now, the Bank of England (BoE) reckoned that the UK economy would enter into a recession phase for the next 15 months, as revealed during the last central bank meeting. Besides, BoE had also warned that the rising inflation fueled by the elevating energy prices would probably further exacerbate the economy into a lengthy recession. On the other side, the UK Manufacturing Production data, which came in at 0.1%, lower than the consensus forecast of 0.4% mirrored that the new order dropped further amid economic uncertainty and heightened recession risk. As of writing, the pair of GBP/USD dropped 0.04% to 1.1680.

In the commodities market, the crude oil price depreciated by -1.12% to $86.70 despite the Nuclear deal between the western countries and Iran being far off the table. Besides, the gold prices depreciated by -0.17% to $1721.80 per troy ounce while the market participants are all eyes on the long-awaited CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jul) | 5.10% | 5.20% | – |

| 14:00 | GBP – Claimant Count Change (Aug) | -10.5K | -13.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | -55.3 | -60 | – |

| 20:30 | USD – Core CPI (MoM) (Aug) | 0.30% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Aug) | 8.50% | 8.10% | – |

| 20:30 | USD – CPI (MoM) (Aug) | 0.00% | -0.10% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 107.85. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 108.50, 109.65

Support level: 107.85, 107.15

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1770.

Resistance level: 1.1770, 1.1835

Support level: 1.1620, 1.1455

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0155.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 1.0000

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 144.15. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6140. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6140, 0.6245

Support level: 0.6030, 0.5925

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2985. MACD which illustrated bearish bias momentum suggests the pair to extend losses toward the support level at 1.2925.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9465

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 89.45.

Resistance level: 89.45, 96.65

Support level: 86.15, 83.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

130922 Morning Session Analysis

13 September 2022 Morning Session Analysis

US Dollar slumped ahead of crucial CPI data tonight.

The Dollar Index which traded against a basket of six major currencies extend its losses to lowest level in more than two weeks as investors had started to profit-taking from US Dollar ahead of US inflation data. The economists forecasted that the US inflation rate would likely to decline in August from a 40-year high in July as easing price for the commodities product would likely to weigh down the inflation risk. Such development would bring some relief to Federal Reserve who have been worrying that the highest inflation in 40 years might continue to jeopardize the US economic growth. The US authorities also predicted that the US Consumer Price Index (CPI) would indicate an 8% increase in August, down from the previous reading of 8.5% in July. As for now, investors would continue to scrutinize the latest updates with regards of the latest US data as well as the Federal Reserve’s monetary policy decision to receive further trading signal. As of writing, the Dollar Index depreciated by 0.64% to 108.30.

In the commodities market, the crude oil price appreciated by 0.01% to $87.75 per barrel as of writing. The crude oil price extends its gains yesterday as the oil supply constraints continue to spur bullish momentum on the crude oil price. According to Reuters, US emergency crude oil stocks fell 8.4-million-barrel last week to 431.1 million barrels, their lowest oil reserve since October 1984. On the other hand, the gold price surged 0.02% to $1725.00 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jul) | 5.10% | 5.20% | – |

| 14:00 | GBP – Claimant Count Change (Aug) | -10.5K | -13.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | -55.3 | -60 | – |

| 20:30 | USD – Core CPI (MoM) (Aug) | 0.30% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Aug) | 8.50% | 8.10% | – |

| 20:30 | USD – CPI (MoM) (Aug) | 0.00% | -0.10% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1730, 1.1850

Support level: 1.1585, 1.1415

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.0185, 1.0270

Support level: 1.0075, 0.9875

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6890, 0.7020

Support level: 0.6725, 0.6595

NZDUSD, H4: NZDUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6190, 0.6330

Support level: 0.6050, 0.5920

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3100, 1.3195

Support level: 1.2955, 1.2845

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 90.25, 96.05

Support level: 86.05, 81.40

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1740.20, 1762.00

Support level: 1720.35, 1693.65

120922 Afternoon Session Analysis

12 September 2022 Afternoon Session Analysis

Euro surged upon the aggressive rate hike path.

The EUR/USD, which traded by majority of investors jumped on the early of the day amid the rate hike expectation from ECB policymakers. According to Reuters, the ECB policymakers had claimed on Saturday that the central bank was suggested to raise its key interest rate to 2% in order to tackle sky-high inflation risk despite a recession would happen. Last week, ECB had increased its interest rate by 75 basis point to 1.25% and the ECB President Christine Lagarde guided for another two or three hikes, while she emphasized that the rates were still far away from a level that will bring inflation back to 2%. Such hawkish statement has sparked the appeal of Euro. At this juncture, the investors would continue to scrutinize the announcement of Eurozone CPI data to anticipate the rate hike decision from ECB. As of writing, EUR/USD appreciated by 0.51% to 1.0090.

In the commodities market, the crude oil price dropped significantly by 1.71% to $85.31 per barrel as of writing as the China lockdown which driven by pandemic Covid-19 had threaten the oil demand. On the other hand, the gold price eased by 0.28% to $1712.82 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY Mid-Autumn Moon Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | -0.6% | 0.3% | – |

| 14:00 | GBP –Manufacturing Production (MoM) (Jul) | -1.6% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1660, 1.1745

Support level: 1.1595, 1.1490

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0180

Support level: 1.0020, 0.9935

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 144.05, 145.60

Support level: 142.35, 140.70

AUDUSD, H4: AUDUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2805

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9635, 0.9715

Support level: 0.9535, 0.9455

CrudeOIL, H1: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 85.15, 87.00

Support level: 82.80, 80.85

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1731.55, 1753.00

Support level: 1712.80, 1694.20

120922 Morning Session Analysis

12 September 2022 Morning Session Analysis

Greenback revived amid the hawkish stance from Fed’s Bullard.

The dollar index, which was traded against a basket of six major currencies, regained its foot after slumping 3 consecutive days as Federal Reserve member reiterated his hawkish stance on the monetary policy path. Last Friday, Federal Reserve Bank of St. Louis President James Bullard revealed that he was leaning toward a third straight 75 basis-point of rate hike in the upcoming meeting, while commented that the market is actually underestimating the rate hikes path of the Federal Reserve. Moreover, he also added that the job reports were reasonably good in the past week, which indicating that the labor market in the US remain tight. This week, the long-awaited inflation figure – CPI will be released, and all the market participants are actually eyeing on the data to react accordingly. Despite, Bullard said a good CPI report should not affect the September rate hike, where the rates of 3.75-4% by end of 2022 is in his pocket. As of writing, the dollar index dropped 0.19% to 108.80.

In the commodities market, the crude oil price went up 0.30% to $86.05 as a new nuclear deal between Iran and the western countries is off the table and will not be signed in the foreseeable future, according to the conversation between Joe Biden and Yair Lapid (Prime Minister of Israel). Besides, the gold prices edged up by 0.06% to $1718.50 per troy ounce following the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CNY Mid-Autumn Moon Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | -0.6% | 0.3% | – |

| 14:00 | GBP –Manufacturing Production (MoM) (Jul) | -1.6% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 109.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1770

Support level: 1.1455, 1.1350

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 1.0000

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 144.15. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6140.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3050. MACD which illustrated bearish bias momentum suggests the pair to extend losses toward the support level at 1.2985.

Resistance level: 1.3050, 1.3140

Support level: 1.2985, 1.2925

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 86.15, 89.45

Support level: 83.50, 80.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

090922 Afternoon Session Analysis

9 September 2022 Afternoon Session Analysis

Euro surged following an expected rate hike.

The overall trend for the pair of EUR/USD was traded lower yesterday amid a strengthening US Dollar following Fed President Jerome Powell unleashing his hawkish tone. Nonetheless, the losses experienced by the Euro were still limited by the aggressive contractionary monetary policy announced yesterday. According to the latest monetary policy statement, the European Central Bank raised its benchmark interest rates by an unprecedented 75 basis points on Thursday to combat the spiking inflation rate, despite the global recession risks still continuing to linger in the financial market. The ECB lifted its deposit rate to 0.75% from 0% and raised the refinancing rate to 1.25%, the highest since 2011. In the ECB press conference, the chairman of the ECB Christine Lagarde revealed that the tightening path would be remained unchanged, where more rate hikes could be expected in the near-term future in order to cool down the overheating economy. However, she also warned that the EU economy is still trapped in the risk of an energy crisis as insufficient energy will lead to an economic slowdown. As of writing, the pair of EUR/USD rose 0.78% to 10070.

In the commodities market, the crude oil price went up 1.34% to $83.88 a barrel as the strengthening of the dollar index led to a cheaper price for non-US oil buyers, whereby the purchasing volume jumped overnight. Besides, the gold prices edged up by 0.62% to $1719.15 per troy ounce following the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Aug) | -30.6K | 15.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 109.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the next support level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1455. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1620.

Resistance level: 1.1620, 1.1775

Support level: 1.1465, 1.1350

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.0075.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 144.15. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6140.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3050. MACD which illustrated bearish bias momentum suggests the pair to extend losses after it successfully breakout below the support level.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully closed its candle below the support level.

Resistance level: 0.9750, 0.9825

Support level: 0.9675, 0.9590

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 83.50. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 83.50, 86.15

Support level: 80.60, 78.20

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

090922 Morning Session Analysis

9 September 2022 Morning Session Analysis

US Dollar surged following Fed unleashed hawkish tone.

The Dollar Index which traded against a basket of six major currencies surged following the Federal Reserve unleashed their hawkish tone toward the economic progression in the United States. According to CNBC, Federal Reserve Chair Jerome Powell emphasized the importance of combating inflation before the public gets too used to higher prices. Market participants began to widely expect the 75-basis point for interest rate hike for this month. The CME Group’s FedWatch tracker speculated around 86% probability of 75 basis point rate hike during the next monetary policy meeting. Though, Federal Reserve will focus at inflation data before the meeting next weeks, when the Bureau of Labor Statistics releases the August Consumer Price Index (CPI) data. The Fed will hold its next monetary policy meeting on 20-21st September, when it will issue an updated economic projections and latest monetary policy decision to stabilize the economy momentum. As of writing, the Dollar Index appreciated by 0.02% to 105.65.

In the commodities market, the crude oil price appreciated by 0.30% to $82.99 per barrel as of writing amid technical correction. Though, the overall prospect for the crude oil still remained bearish following the US stockpile build hit nearly five months high. According to Energy Information Administration (EIA), the crude oil inventories came in at 8.844M, higher than the market forecast at -0.250M. On the other hand, the gold market depreciated by 0.01% to $1710.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Aug) | -30.6K | 15.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0320, 1.0745

Support level: 0.9875, 0.9400

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 145.35

Resistance level: 145.35, 152.80

Support level: 140.75, 132.85

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6190, 0.6330

Support level: 0.6050, 0.5920

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3130, 1.3320

Support level: 1.2955, 1.2755

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.65, 96.05

Support level: 81.40, 75.25

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1717.60. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1717.60, 1737.35

Support level: 1693.65, 1680.00