080922 Afternoon Session Analysis

8 September 2022 Afternoon Session Analysis

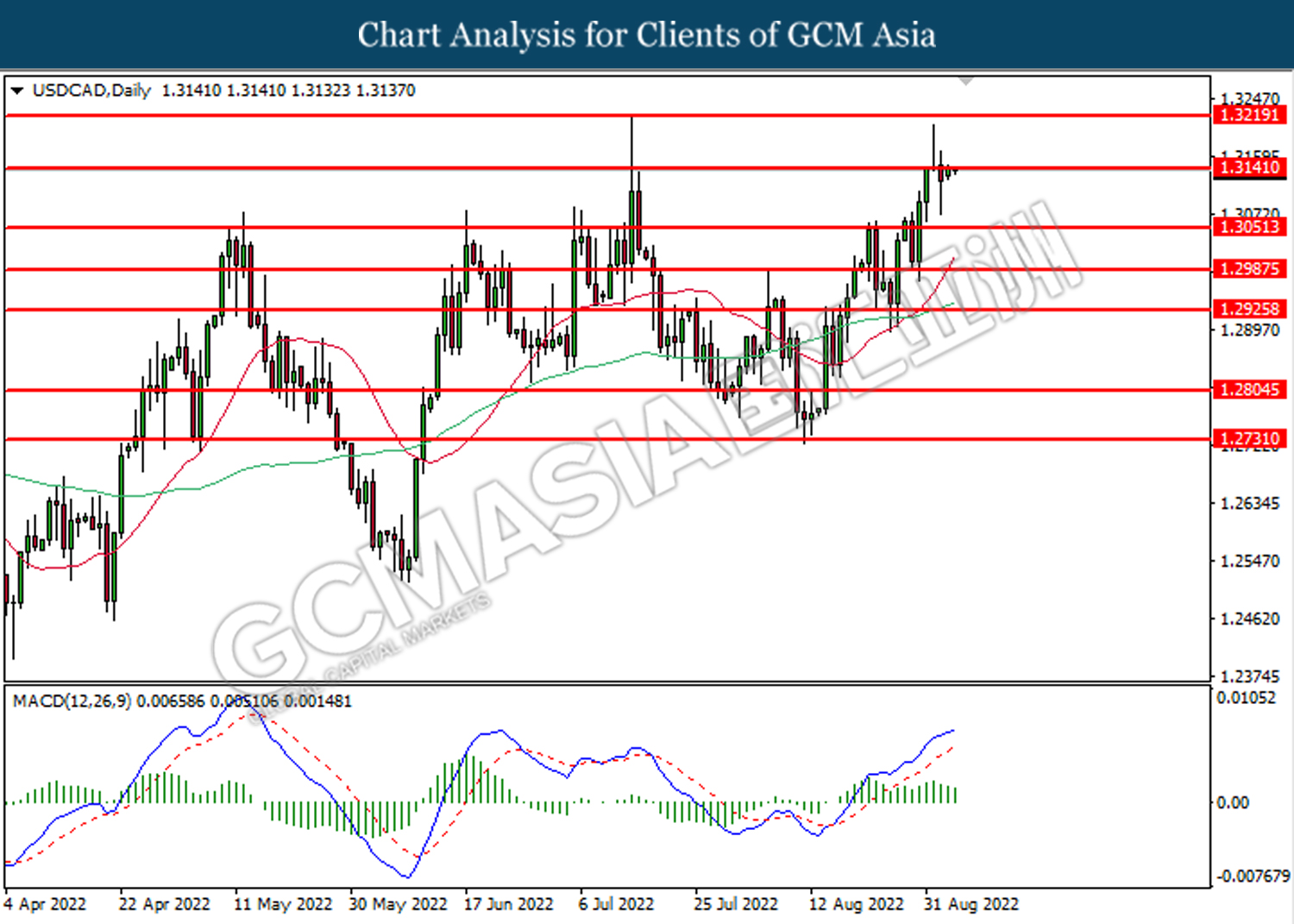

Canadian dollar surged following rate hike decision.

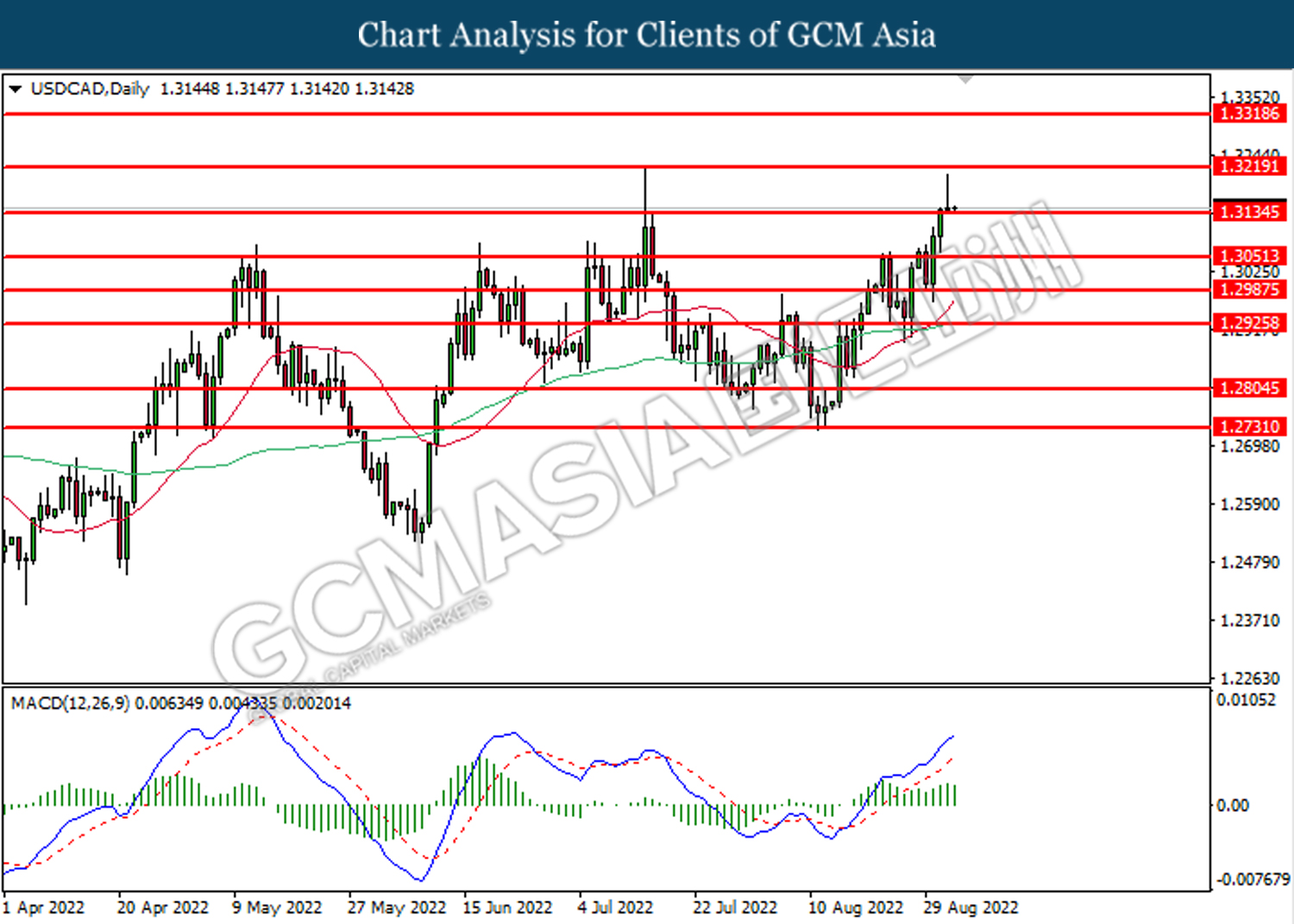

The Canadian dollar, which is one of the major currencies that is majorly traded by investors, jumped after the long-awaited rate hike decision. Yesterday, the Bank of Canada (BoC) adjusted the cash rate upward by 0.75%, from 2.50% to 3.25%. In Canada, the inflation measured figure – CPI eased in July to 7.6% from 8.1% due to the decline in energy prices. However, the Core CPI which excludes the gasoline price, pointed to a further build-up of the price pressures, particularly in the services sector. On the other side, the labour market in Canada remained tight while the domestic demand remained strong. Given the strong inflation outlook, the members of the BoC reckon that the policy interest rate will need to rise further, in order to maintain price stability and achieve the long-term inflation target – 2%. Besides, the Ivey Purchasing Managers Index (PMI) which was released yesterday, showed a reading of 60.9, higher than the consensus forecast of 48.3. With such bullish data, the value of the Canadian dollar surged further, dragging the currency pair of USD/CAD to a lower level. As of writing, USD/CAD rebound by 0.08% to 1.3135.

In the commodities market, the crude oil price up 0.86% to $82.50 a barrel as the EIA Short Term Energy report showed that the US crude production and petroleum demand would both rise in 2022 amid the ongoing economic recovery in the US. Besides, the gold prices edged down by -0.17% to $1715.60 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:15 EUR ECB Interest Rate Decision (Sep)

20:45 EUR ECB Press Conference

21:10 USD Fed Chair Powell Speaks

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Sep) | 0.00% | 0.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.75% | – | – |

| 20:30 | USD – Initial Jobless Claims | 232K | 240K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 3.326M | – | – |

Technical Analysis

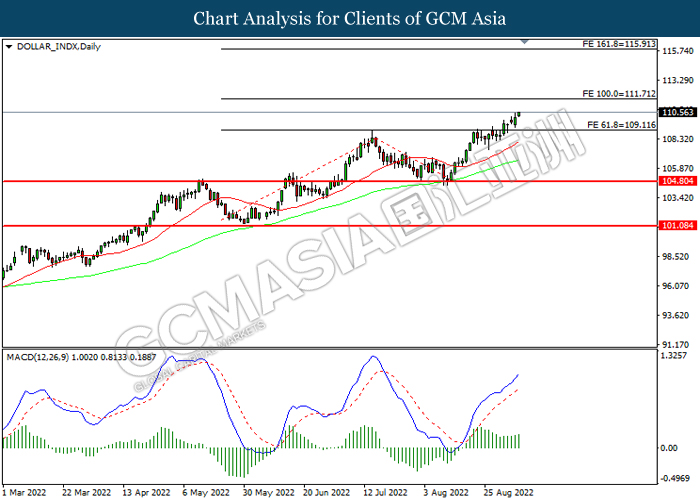

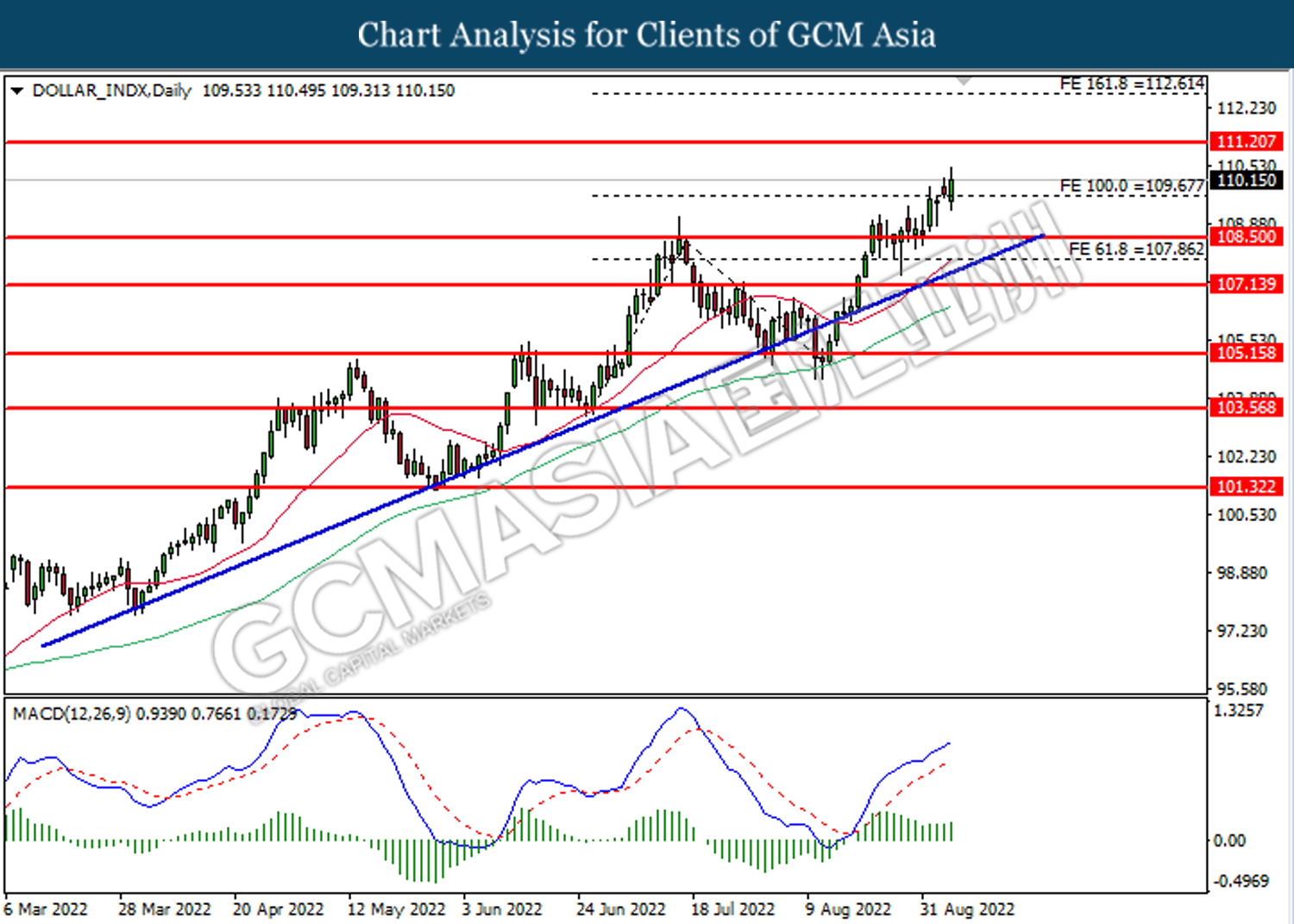

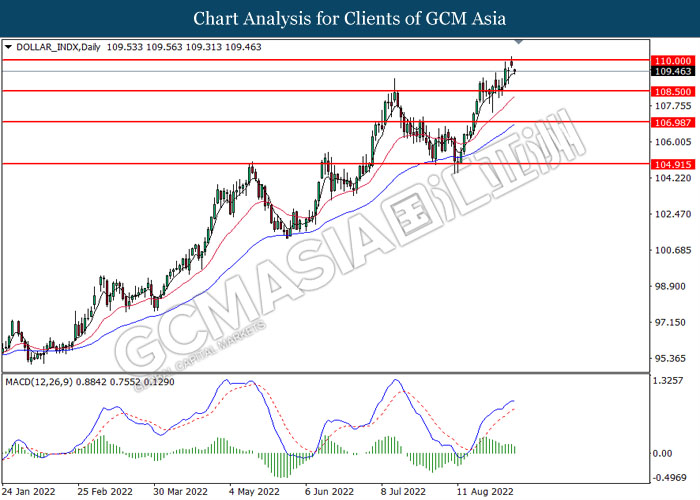

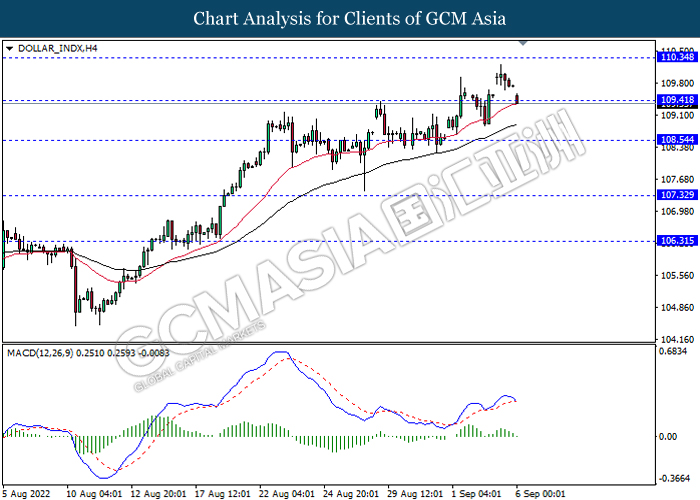

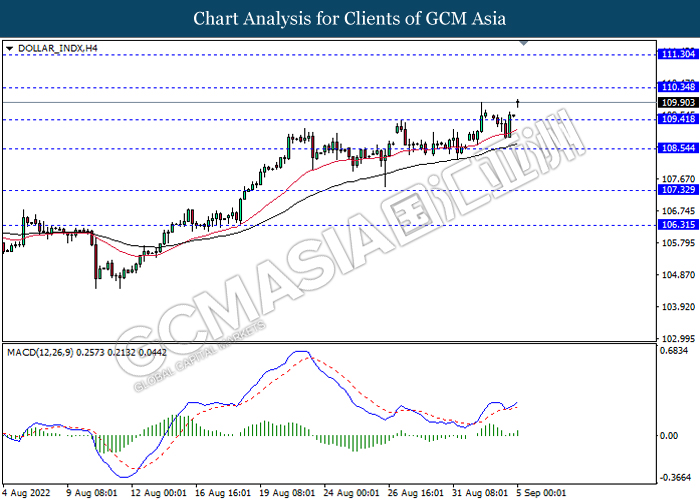

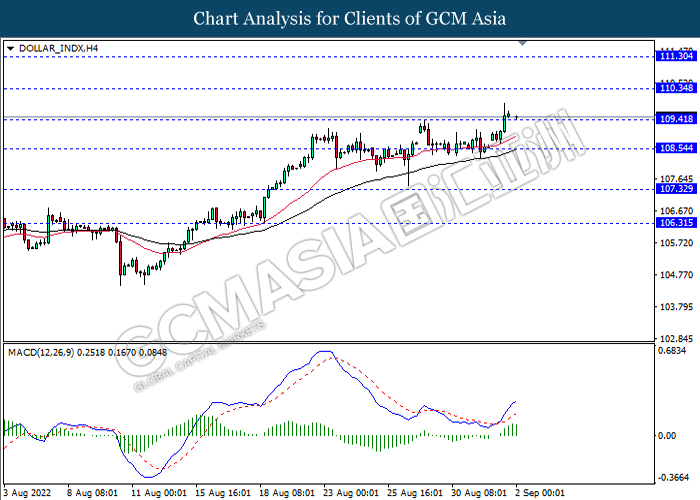

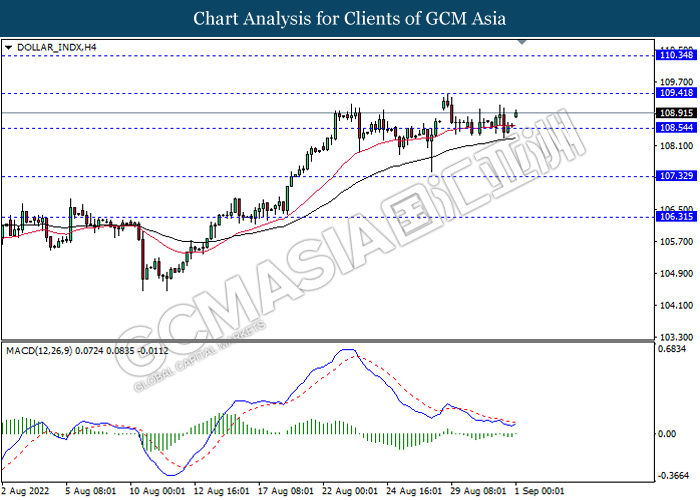

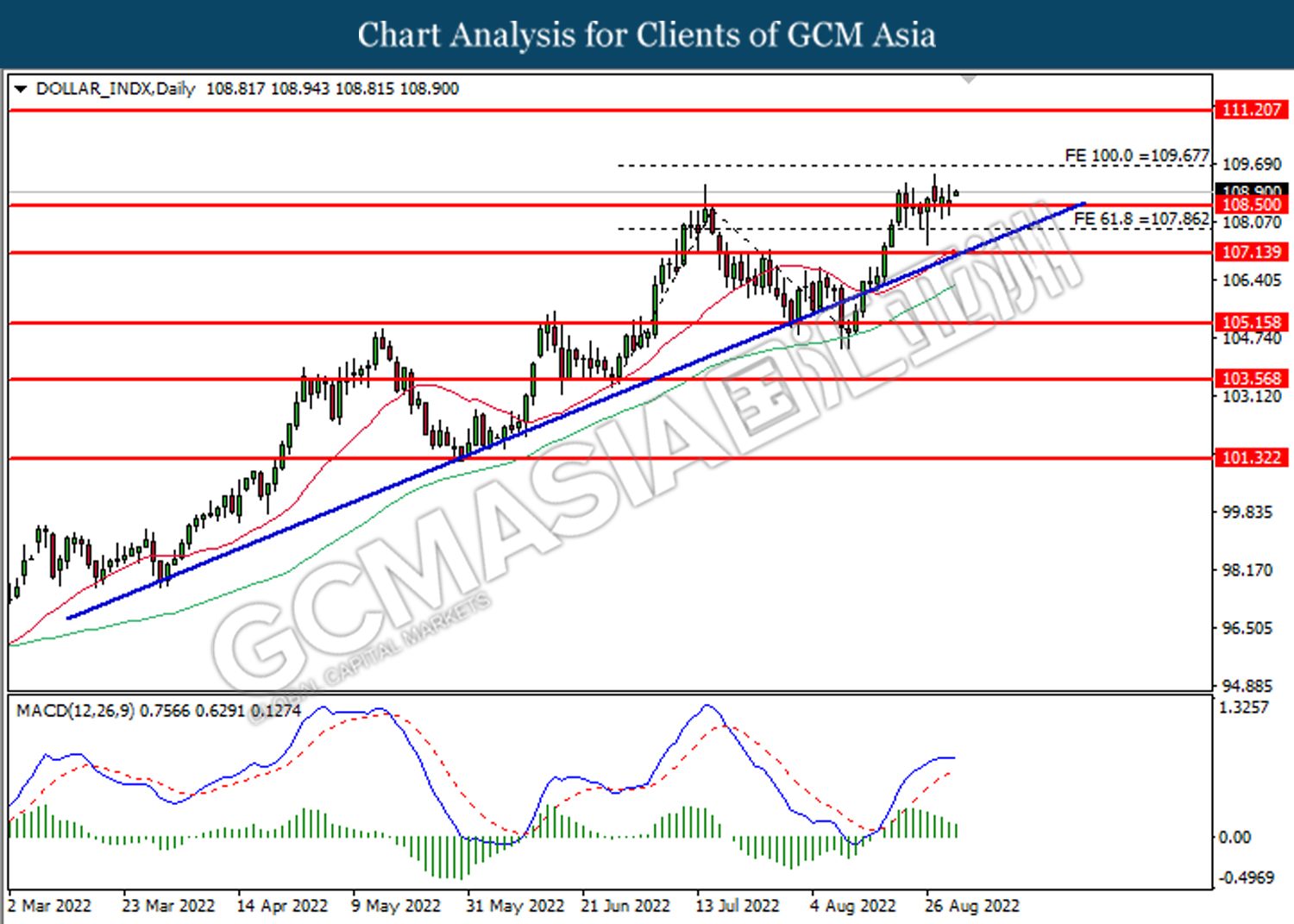

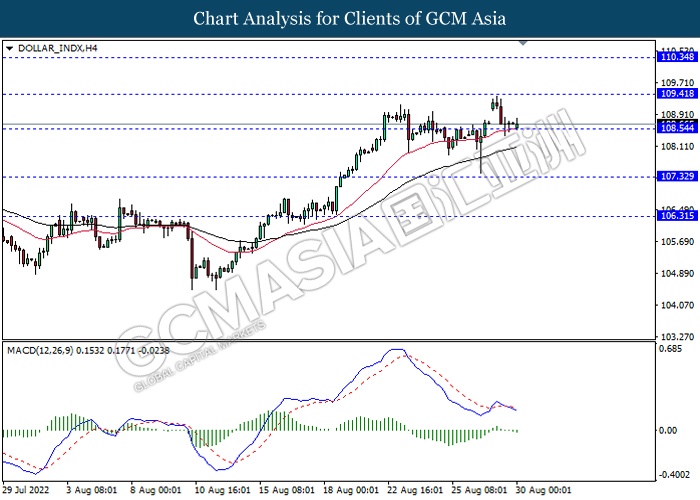

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 109.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

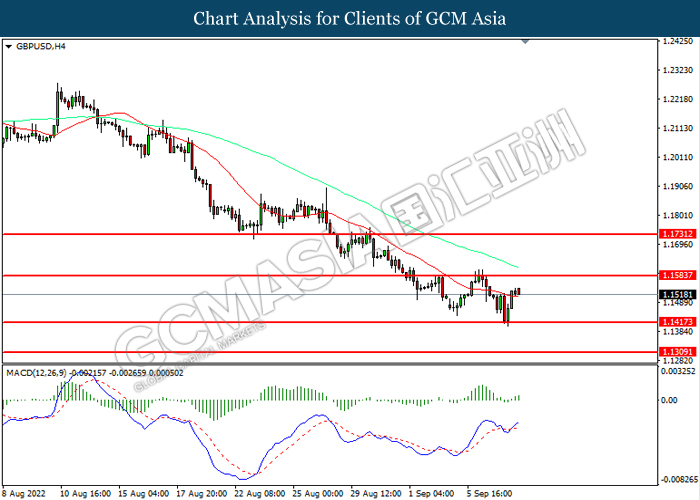

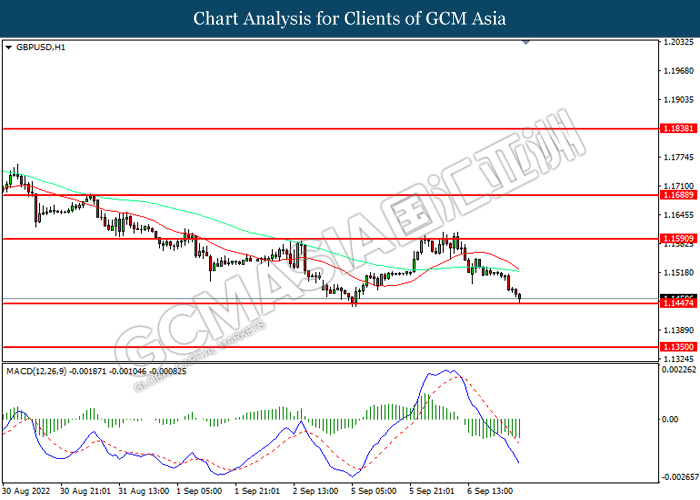

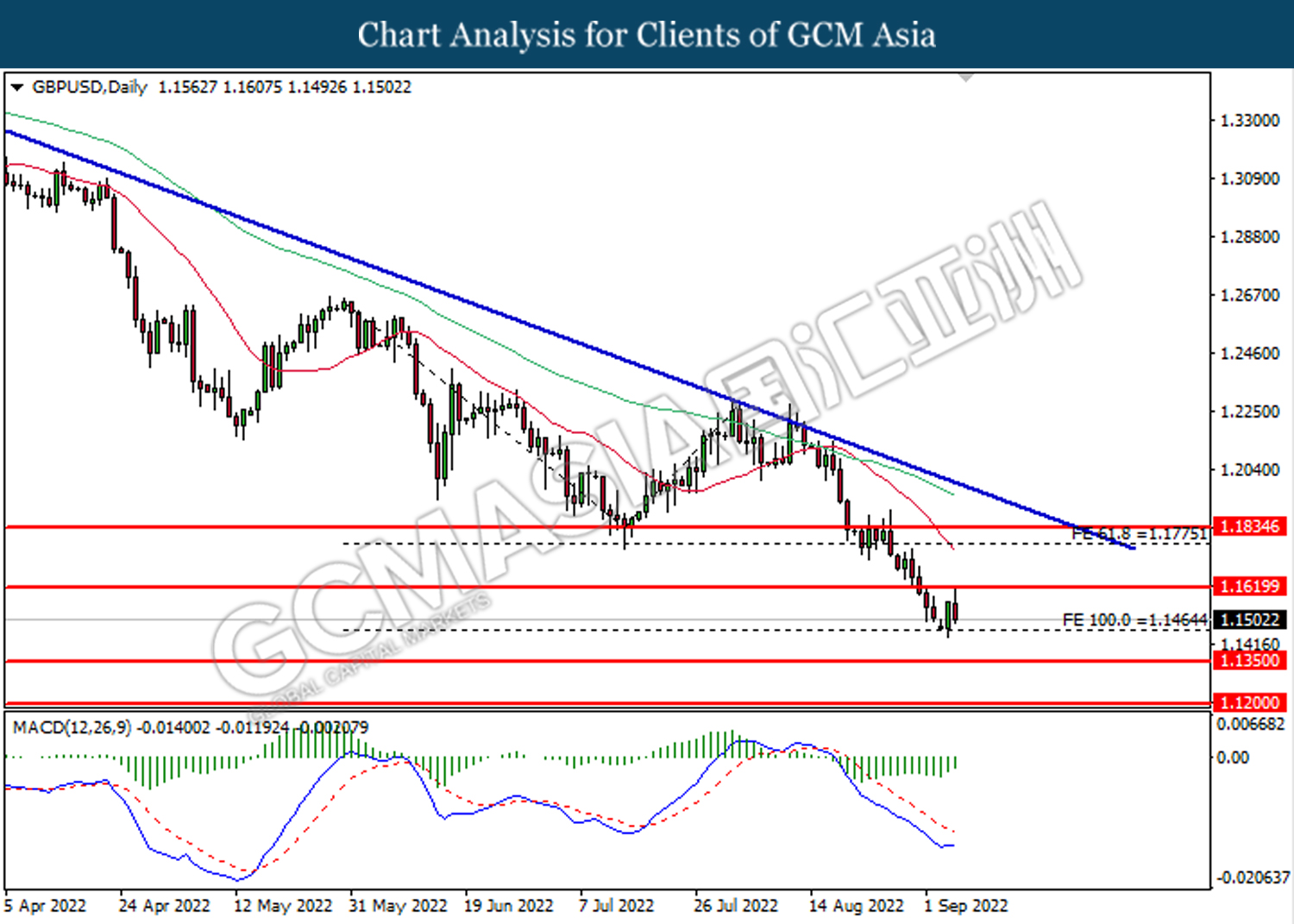

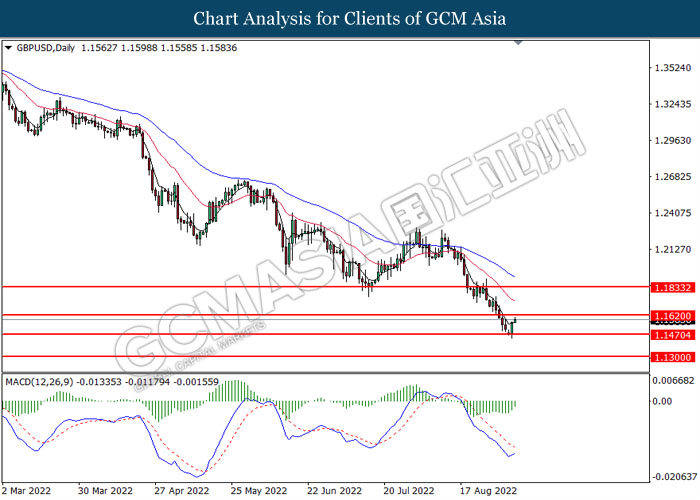

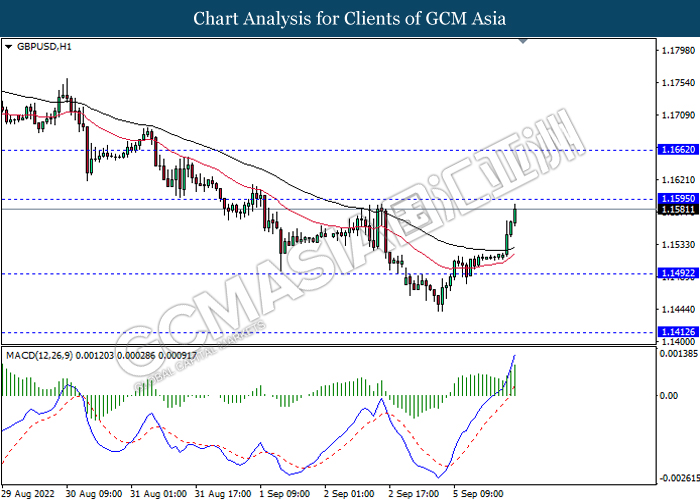

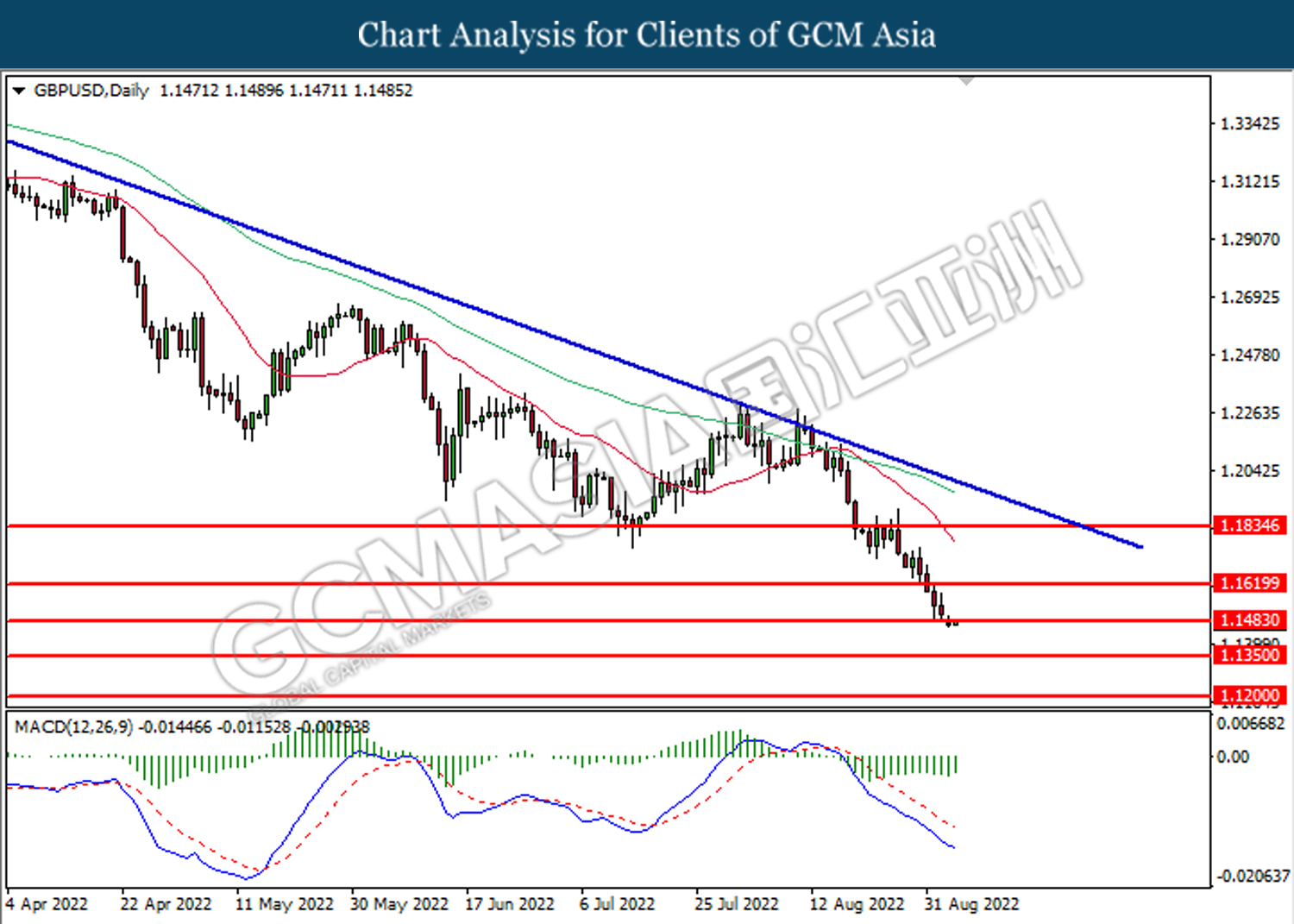

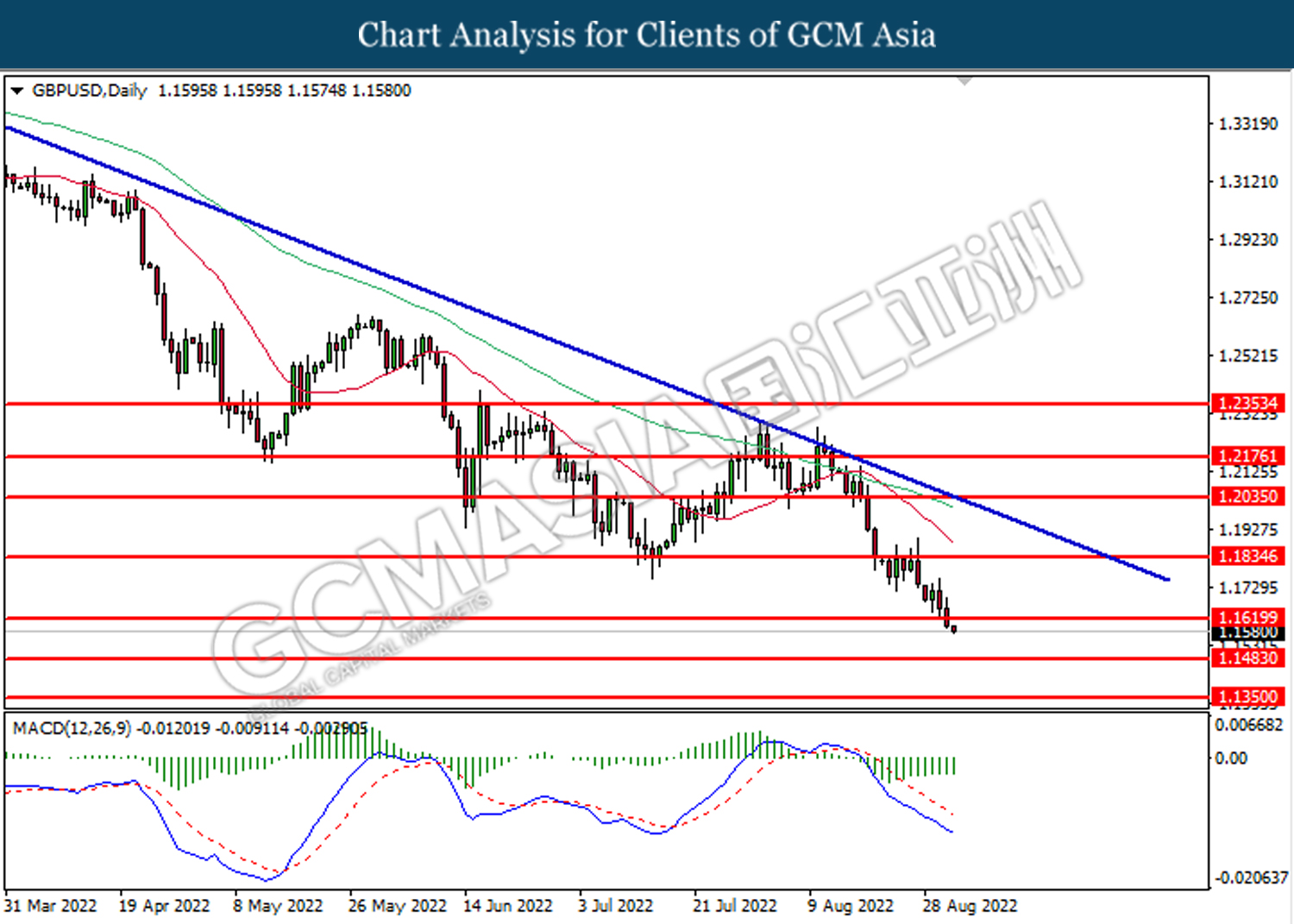

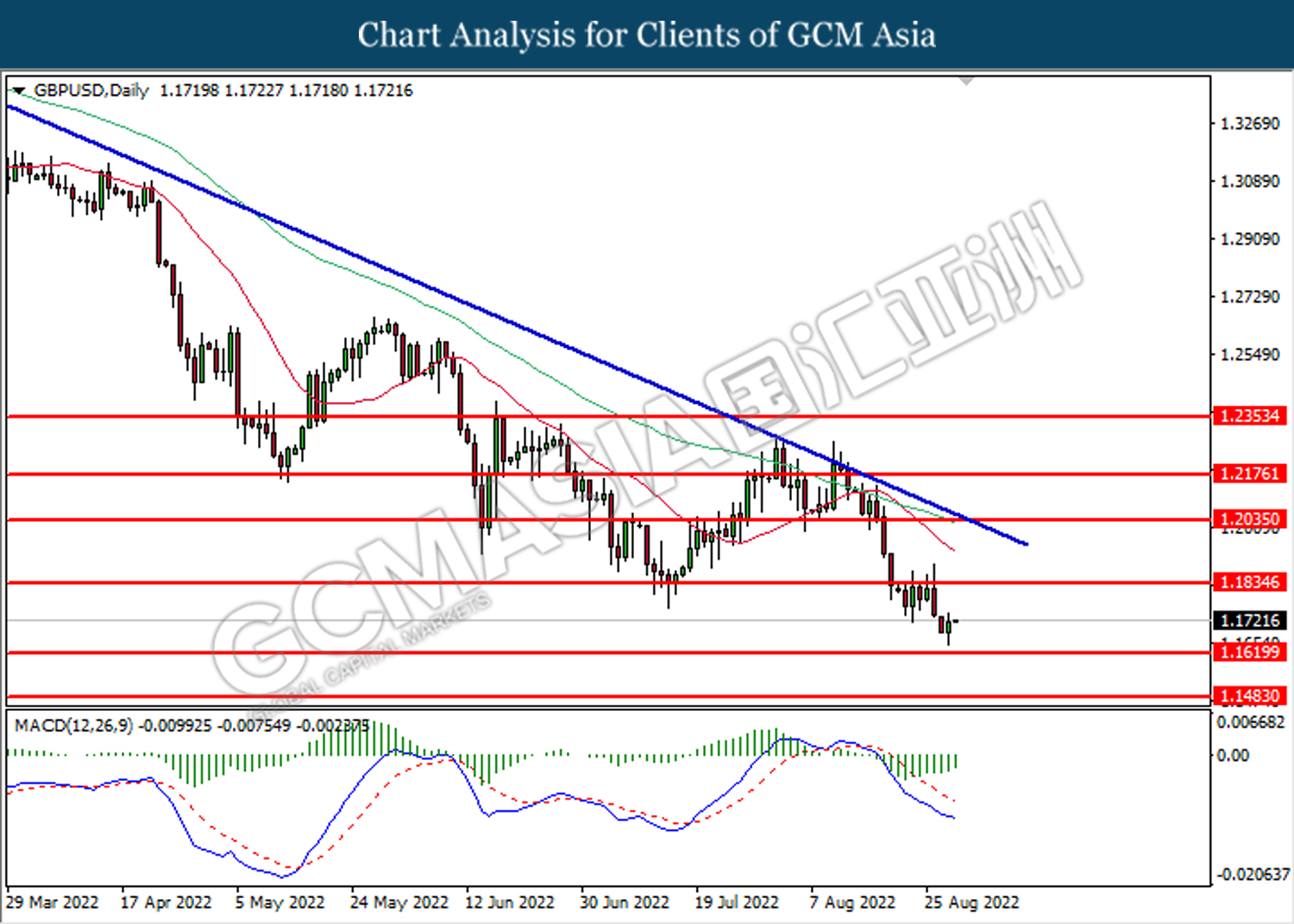

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound for short term.

Resistance level: 1.1620, 1.1775

Support level: 1.1465, 1.1350

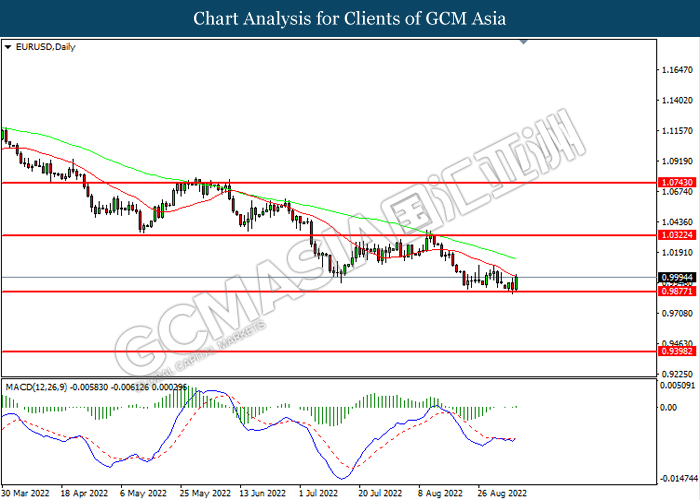

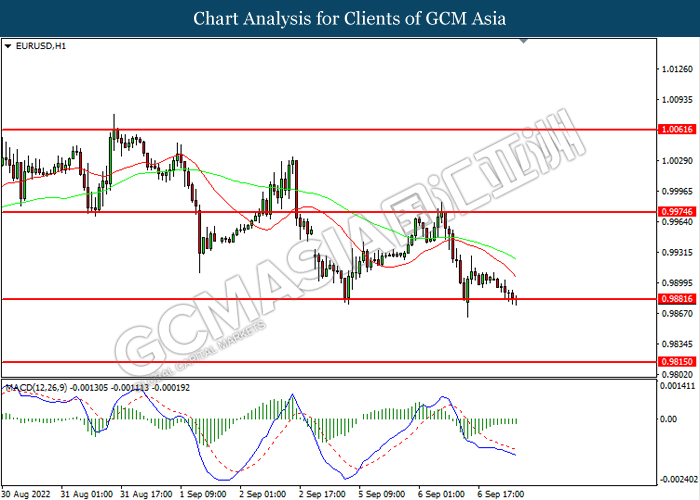

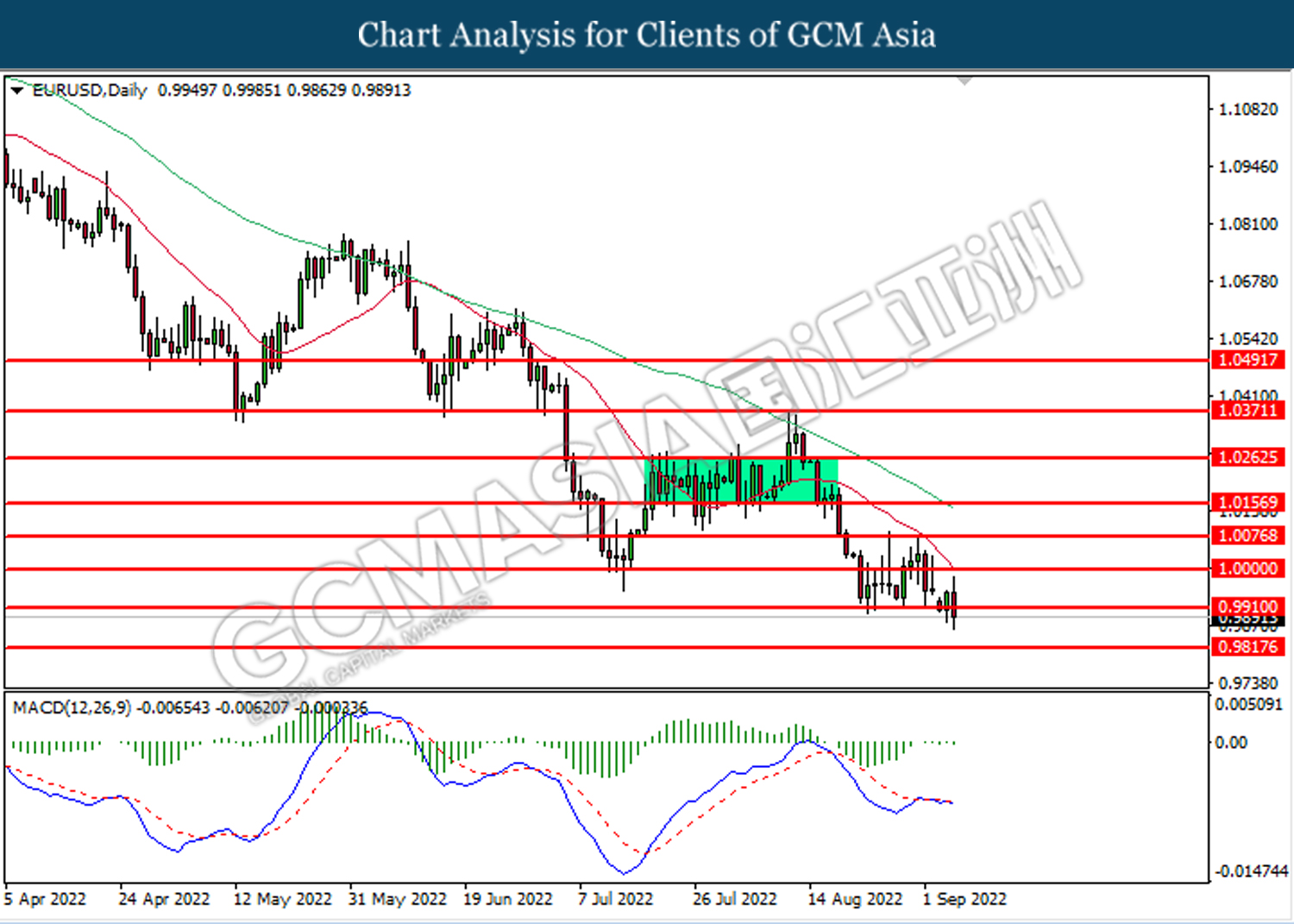

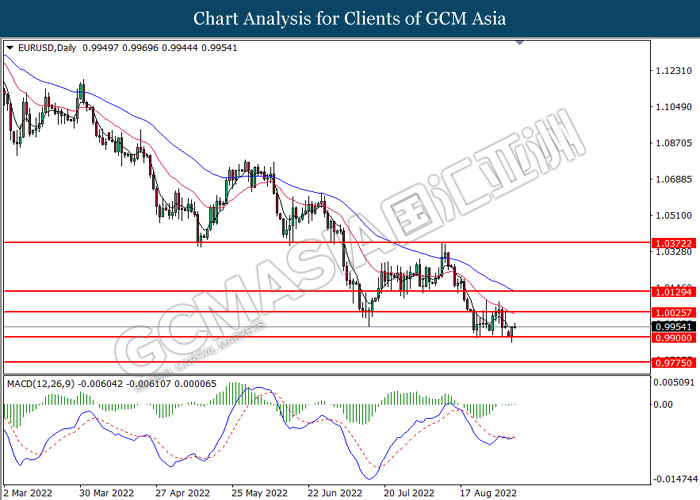

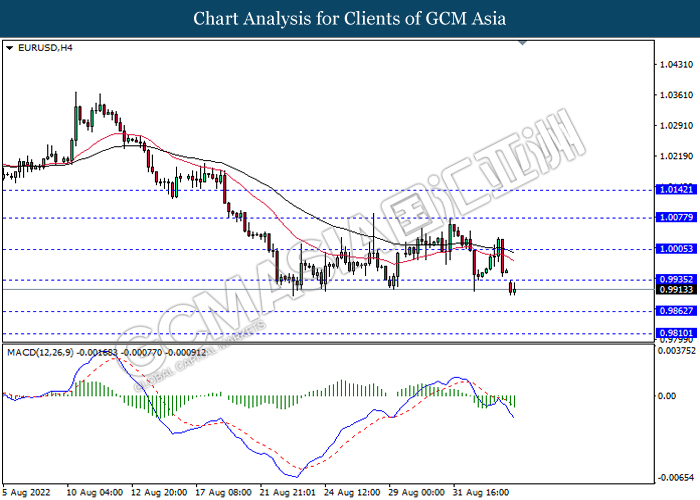

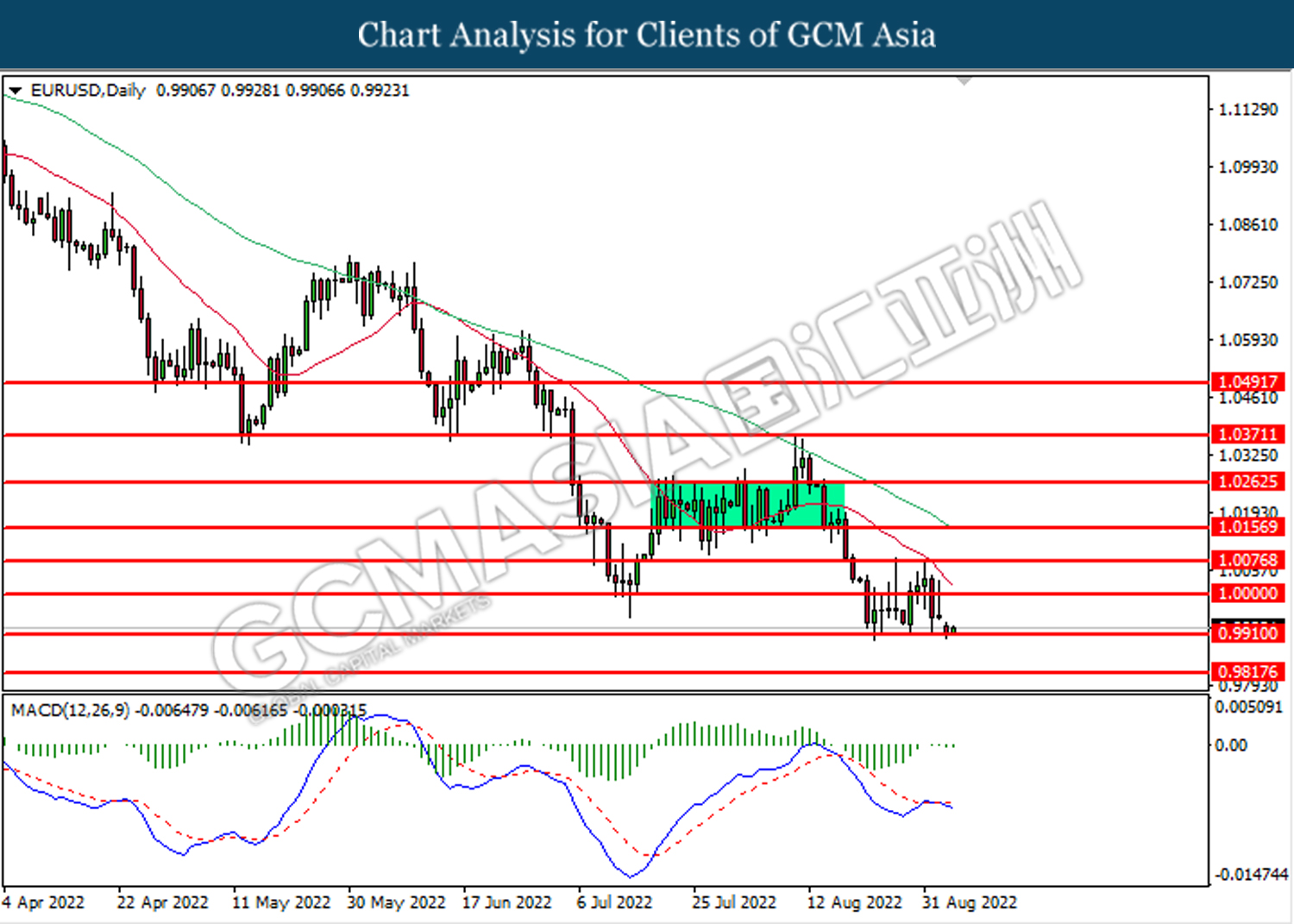

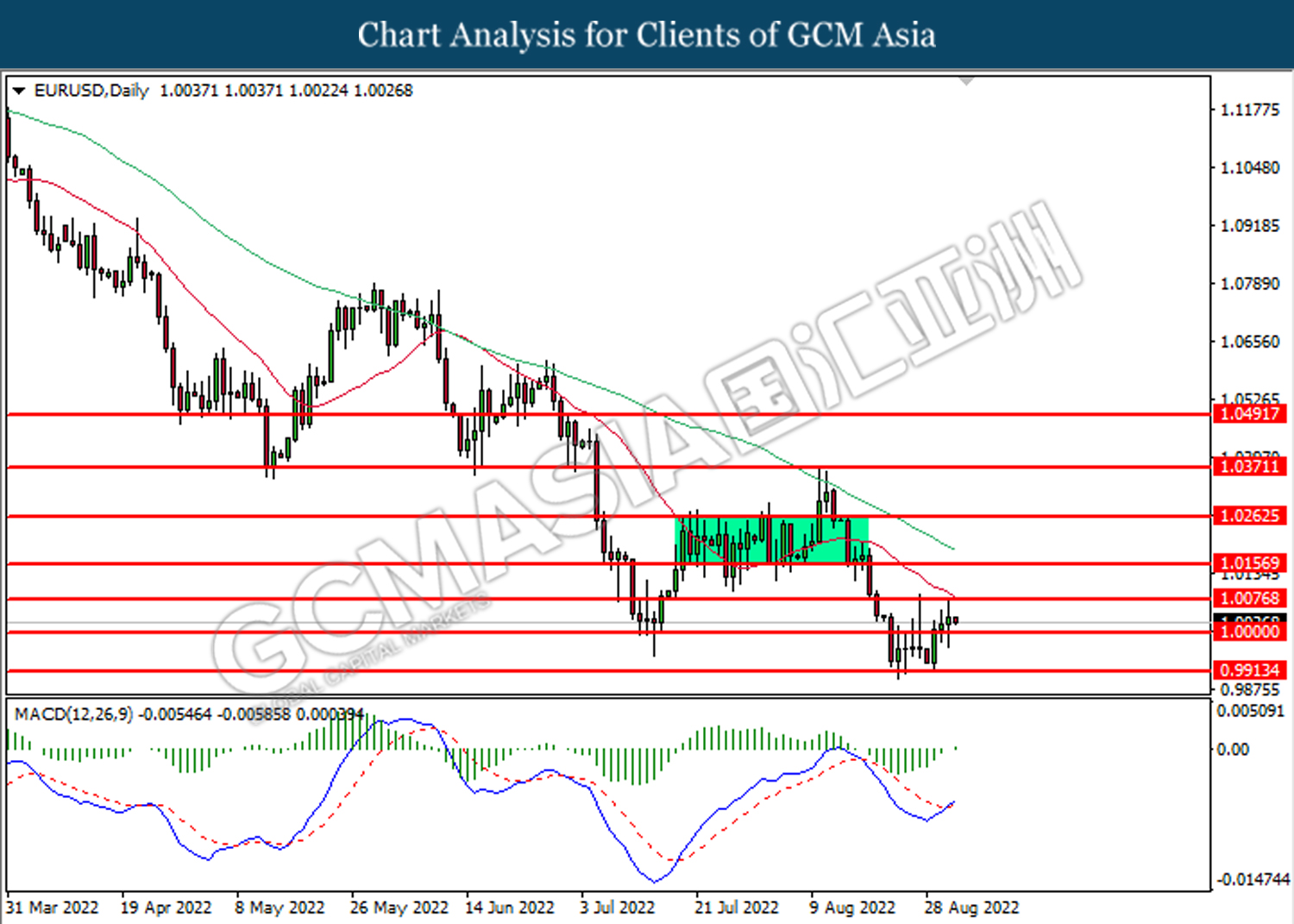

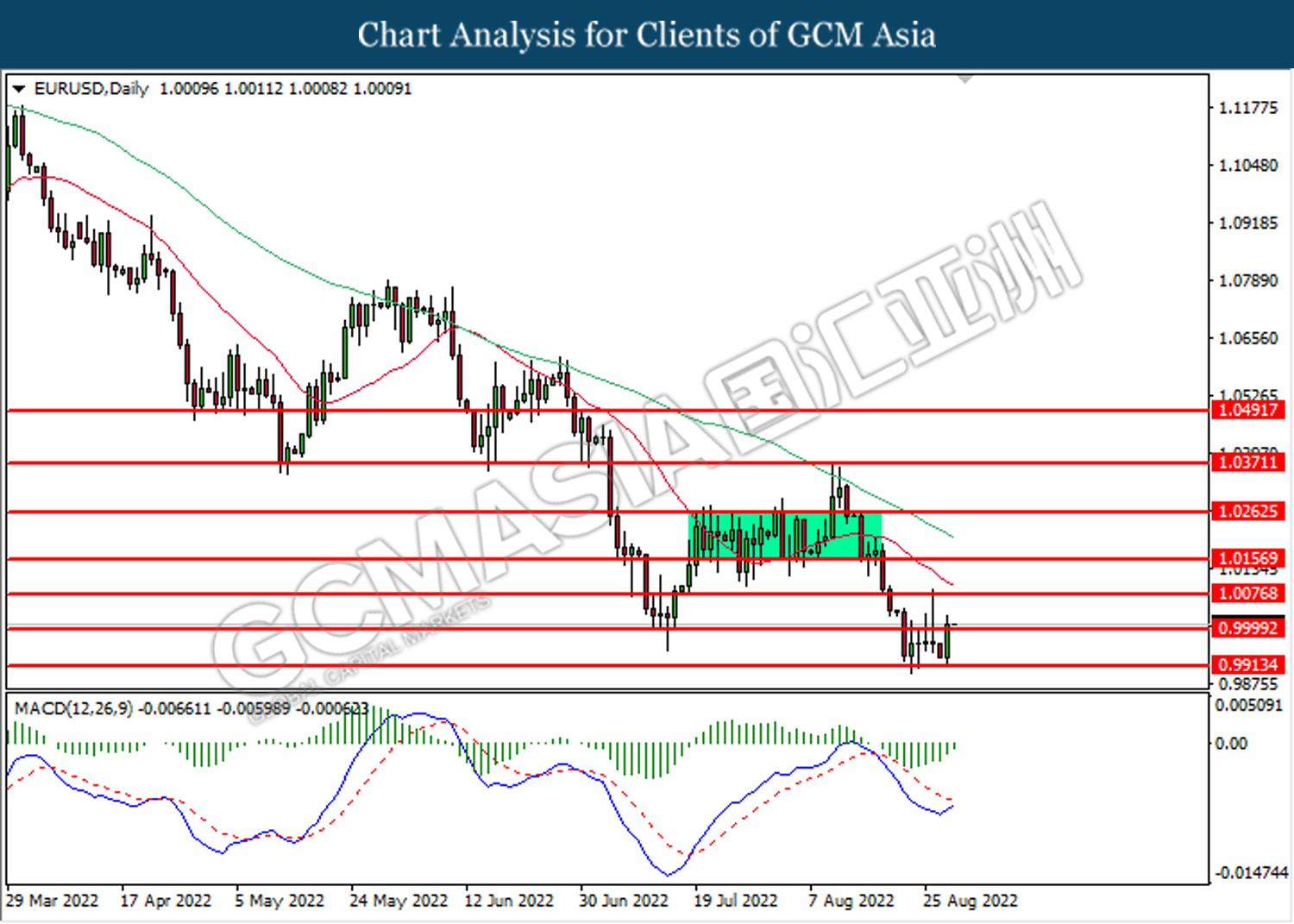

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.0000.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9820

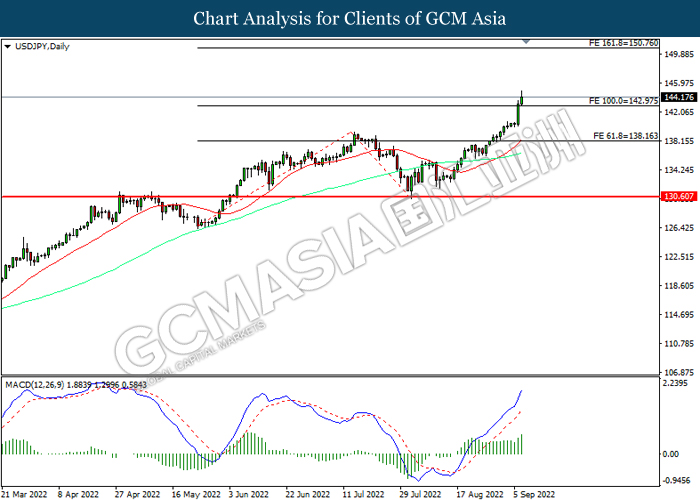

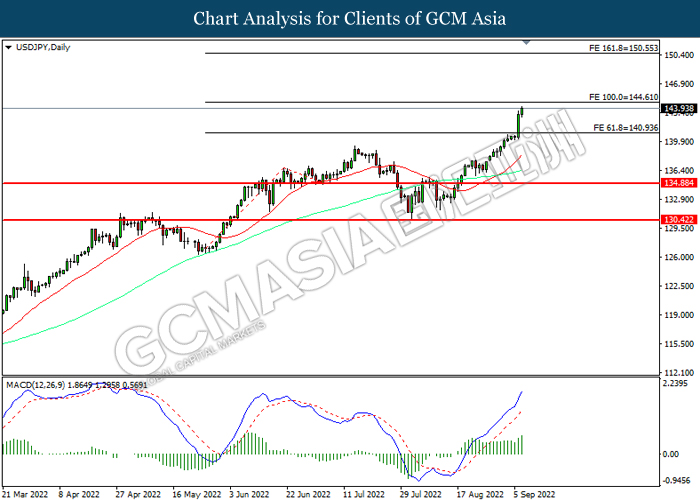

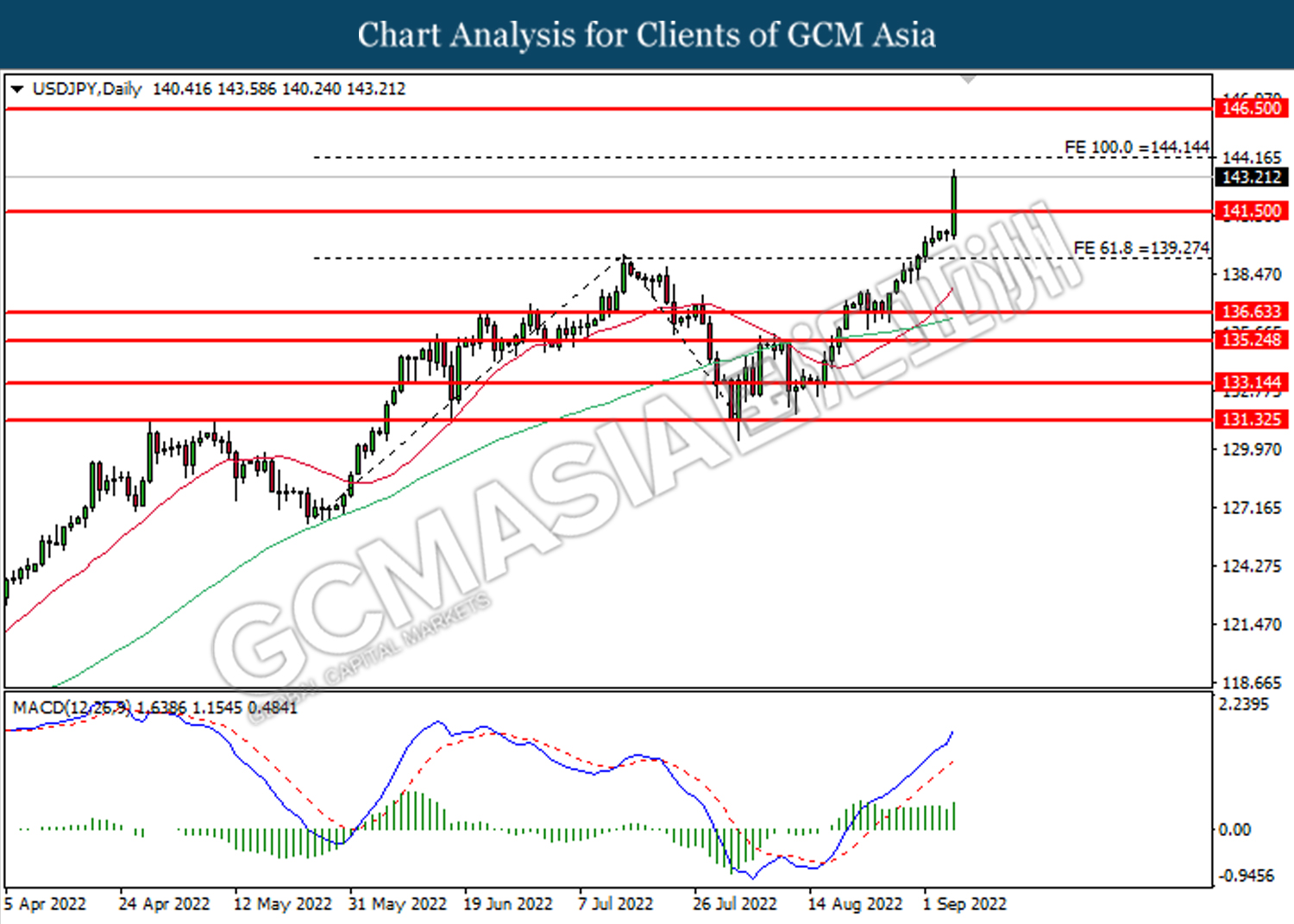

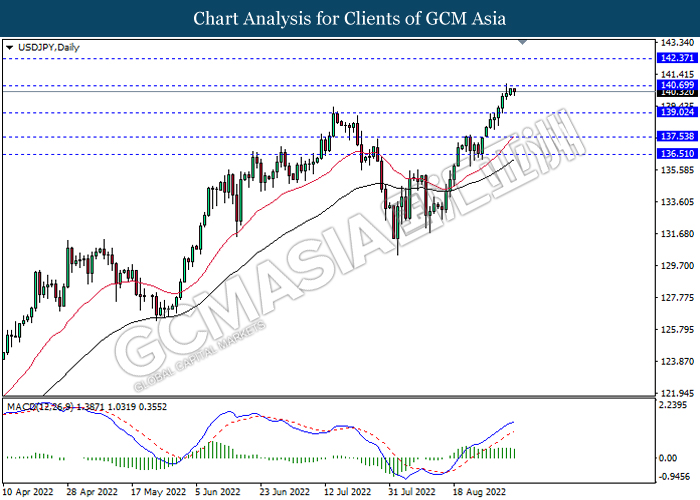

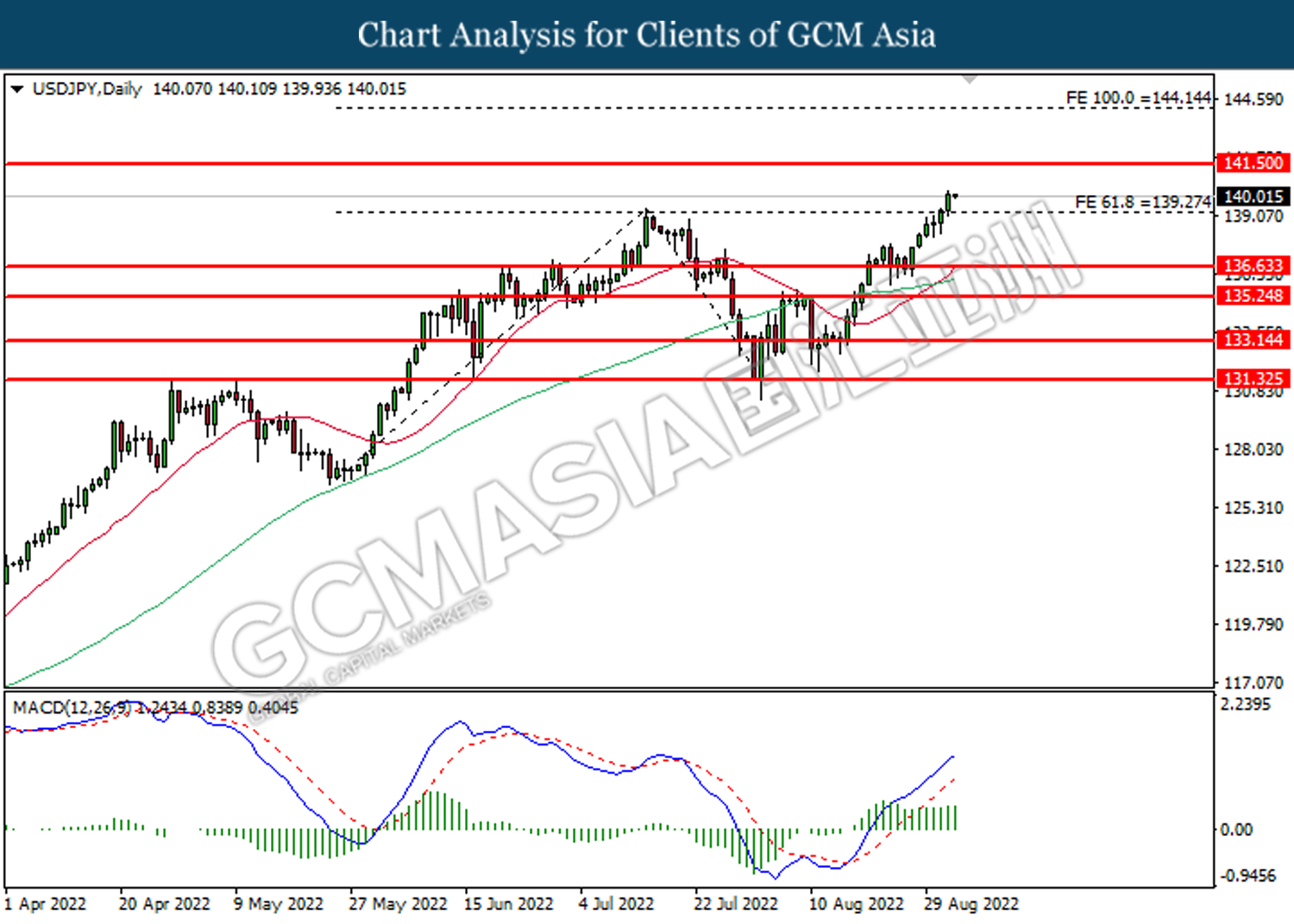

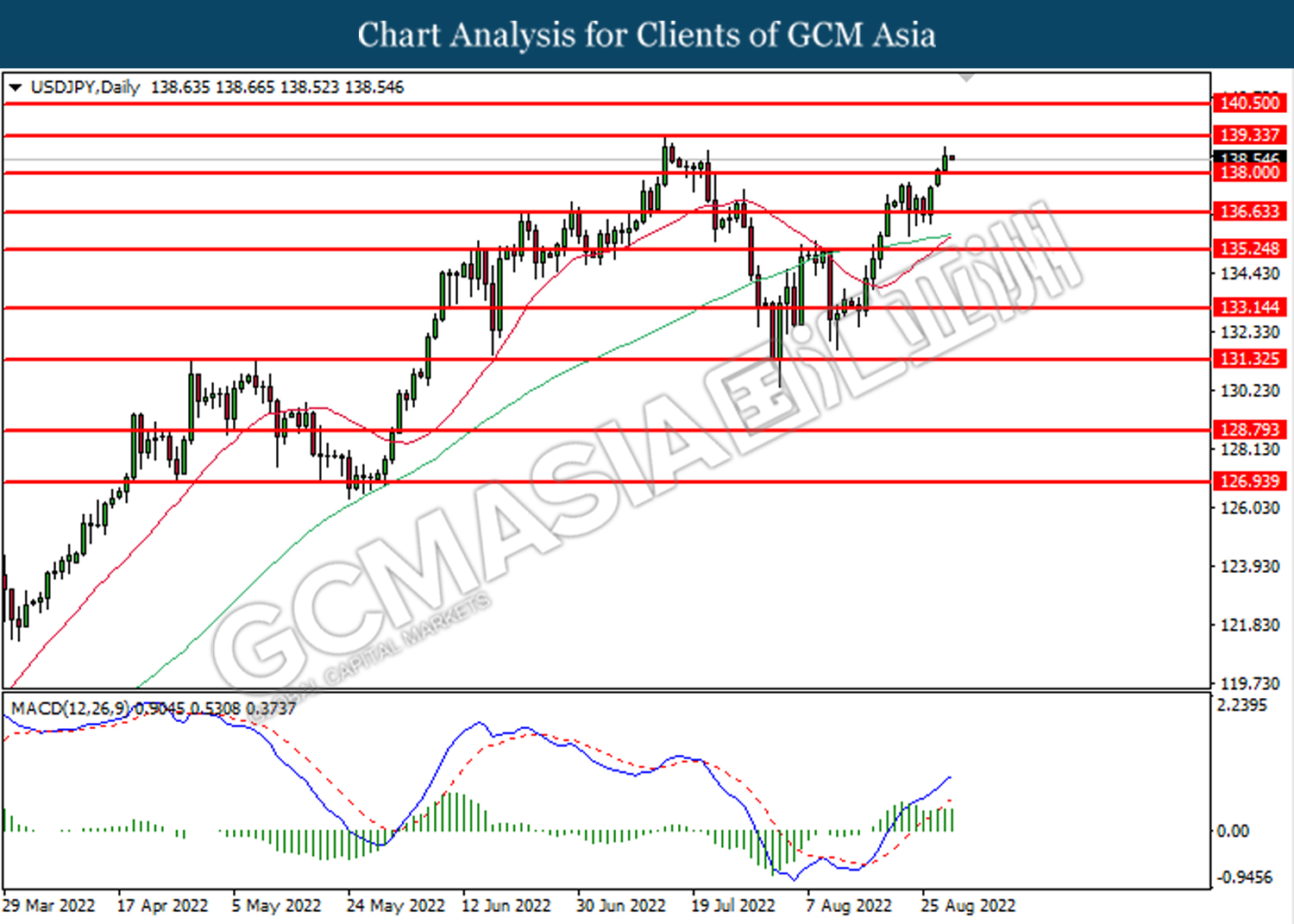

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

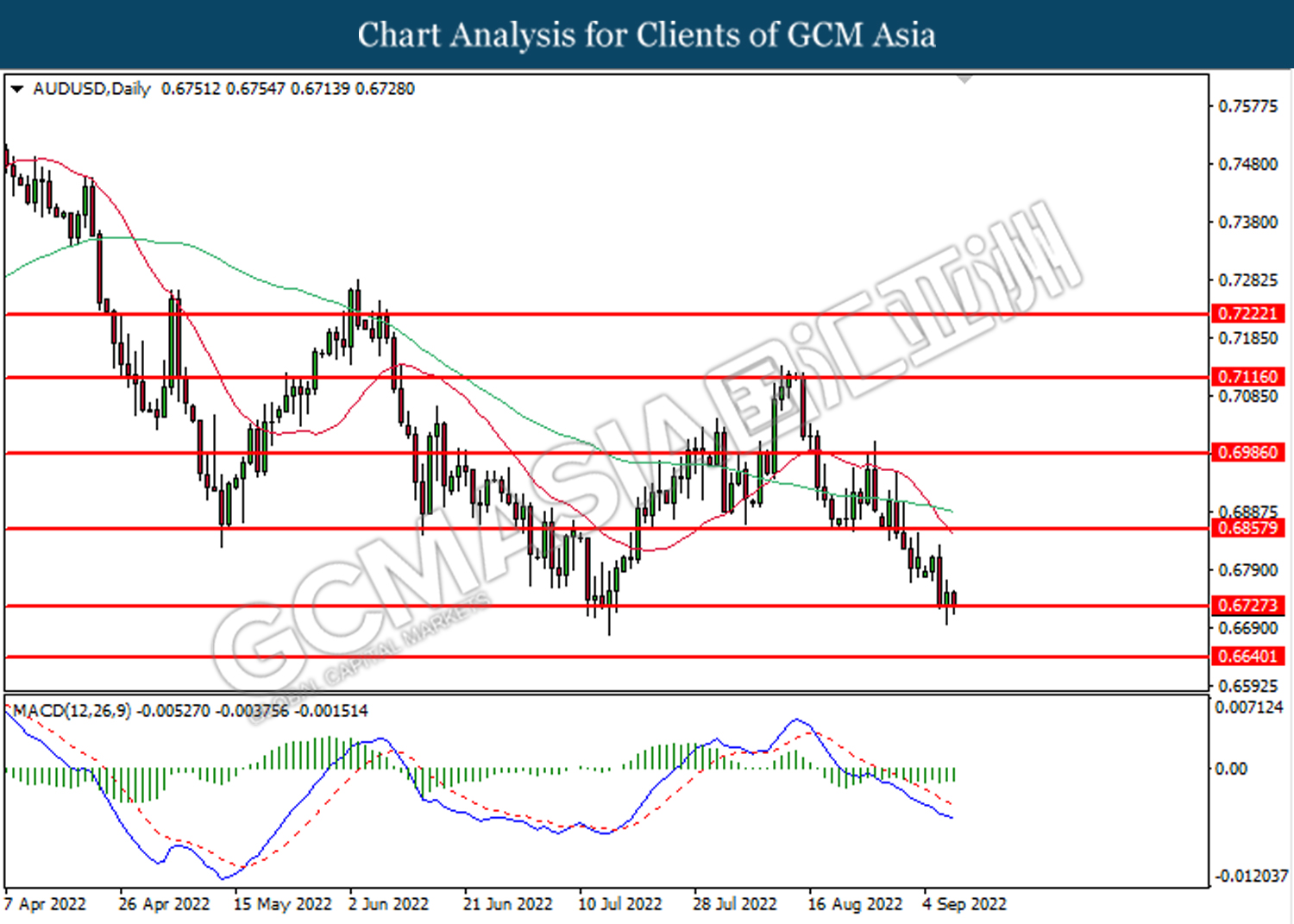

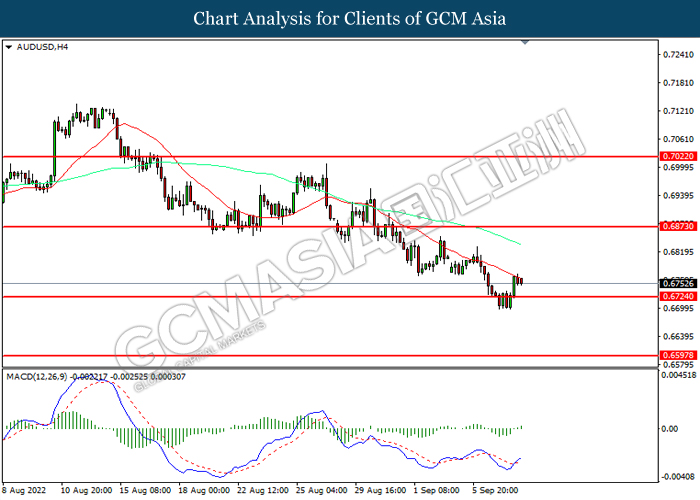

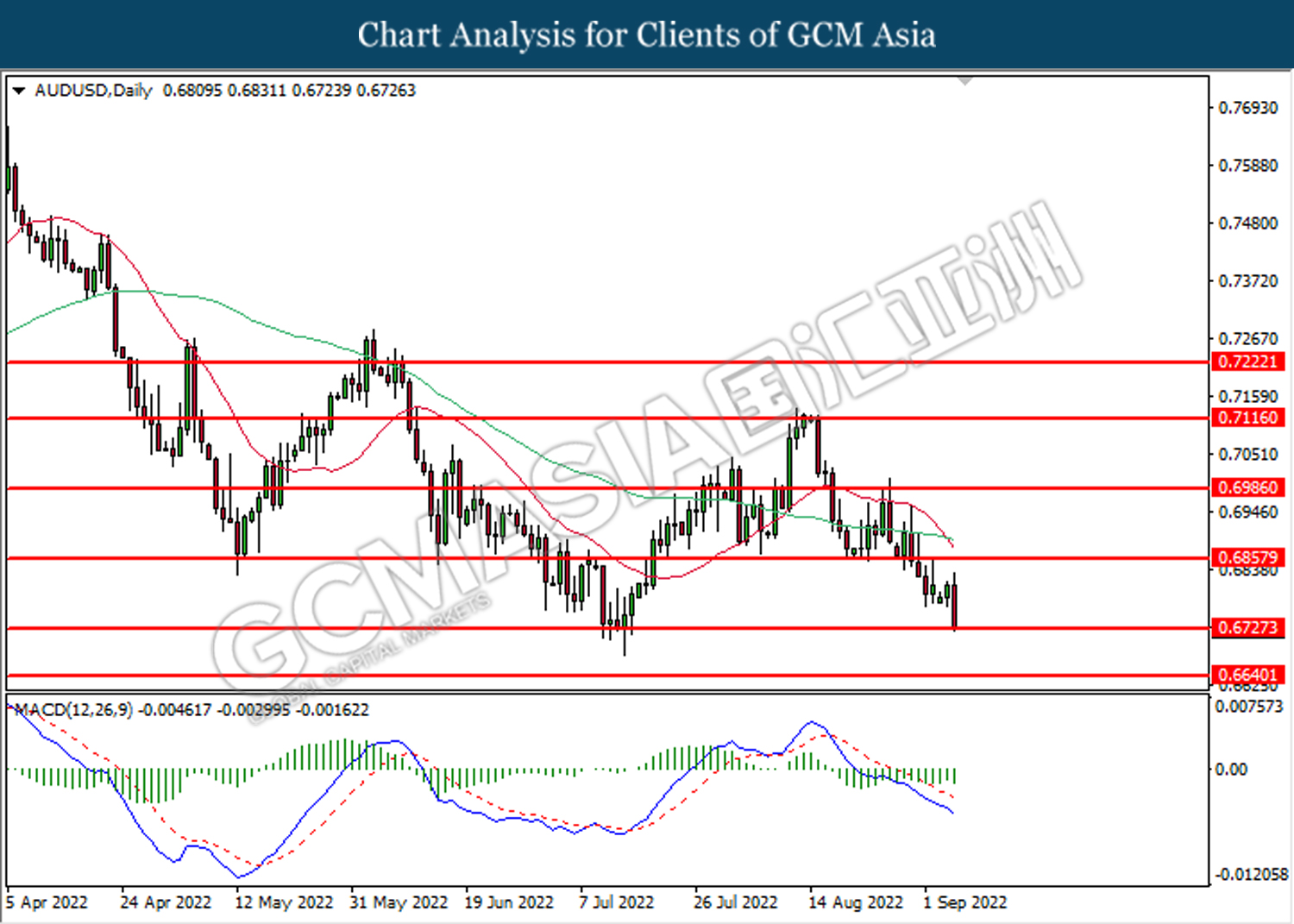

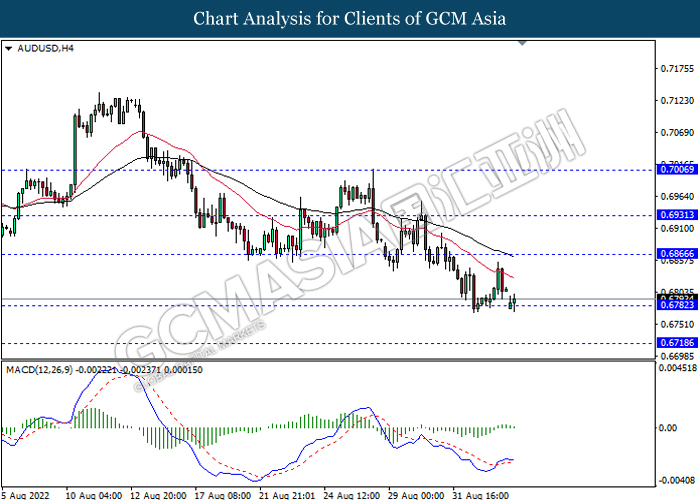

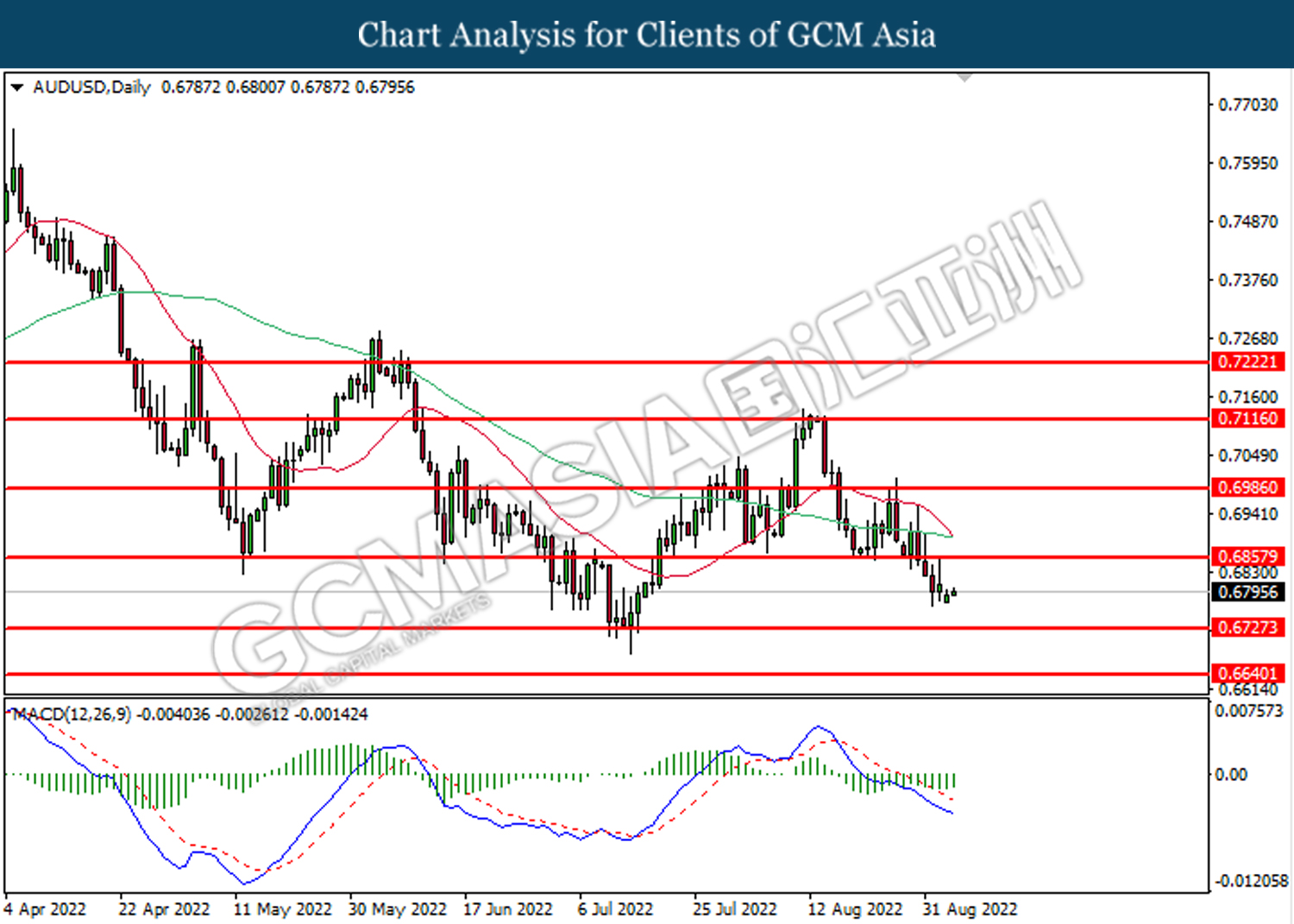

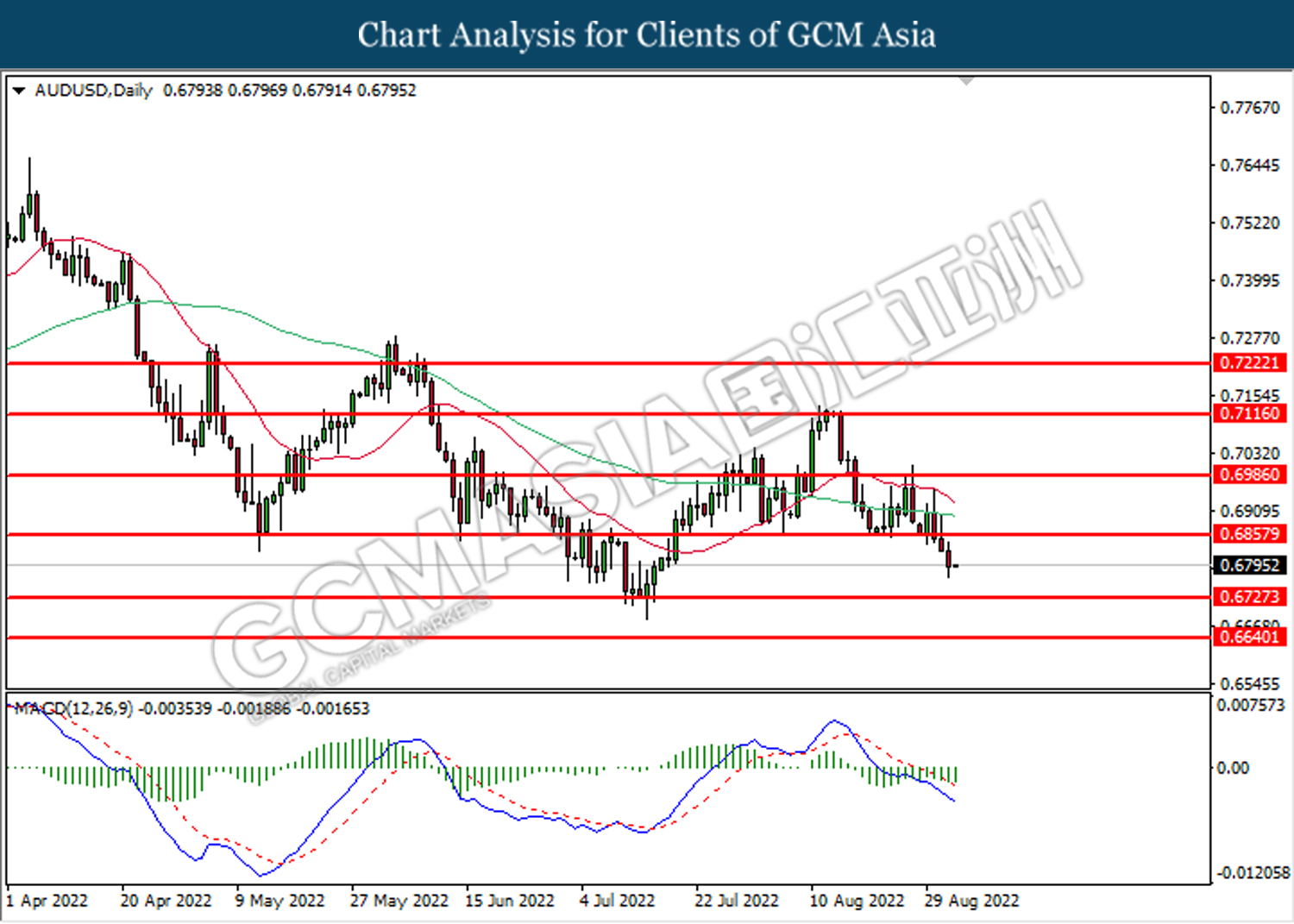

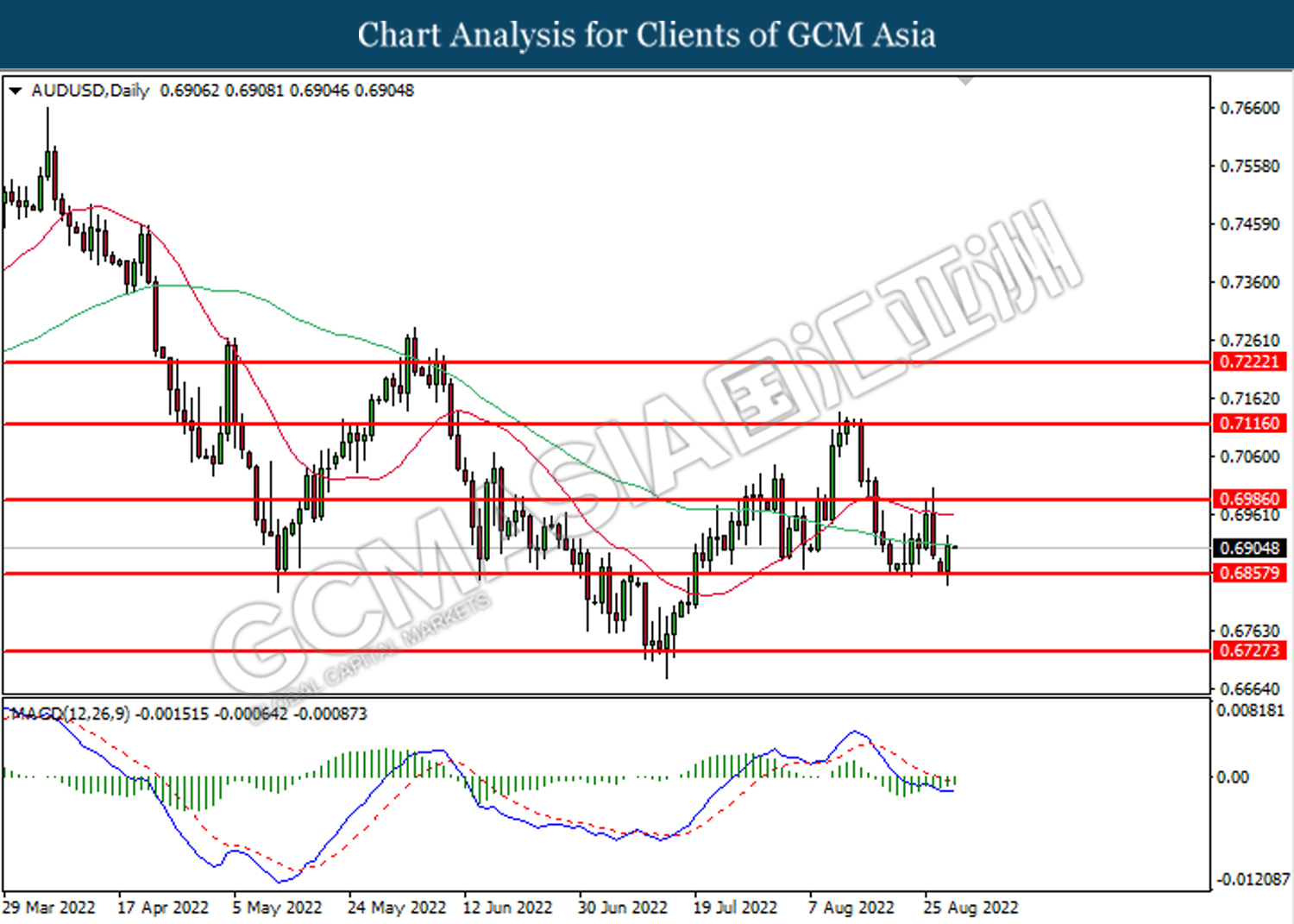

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

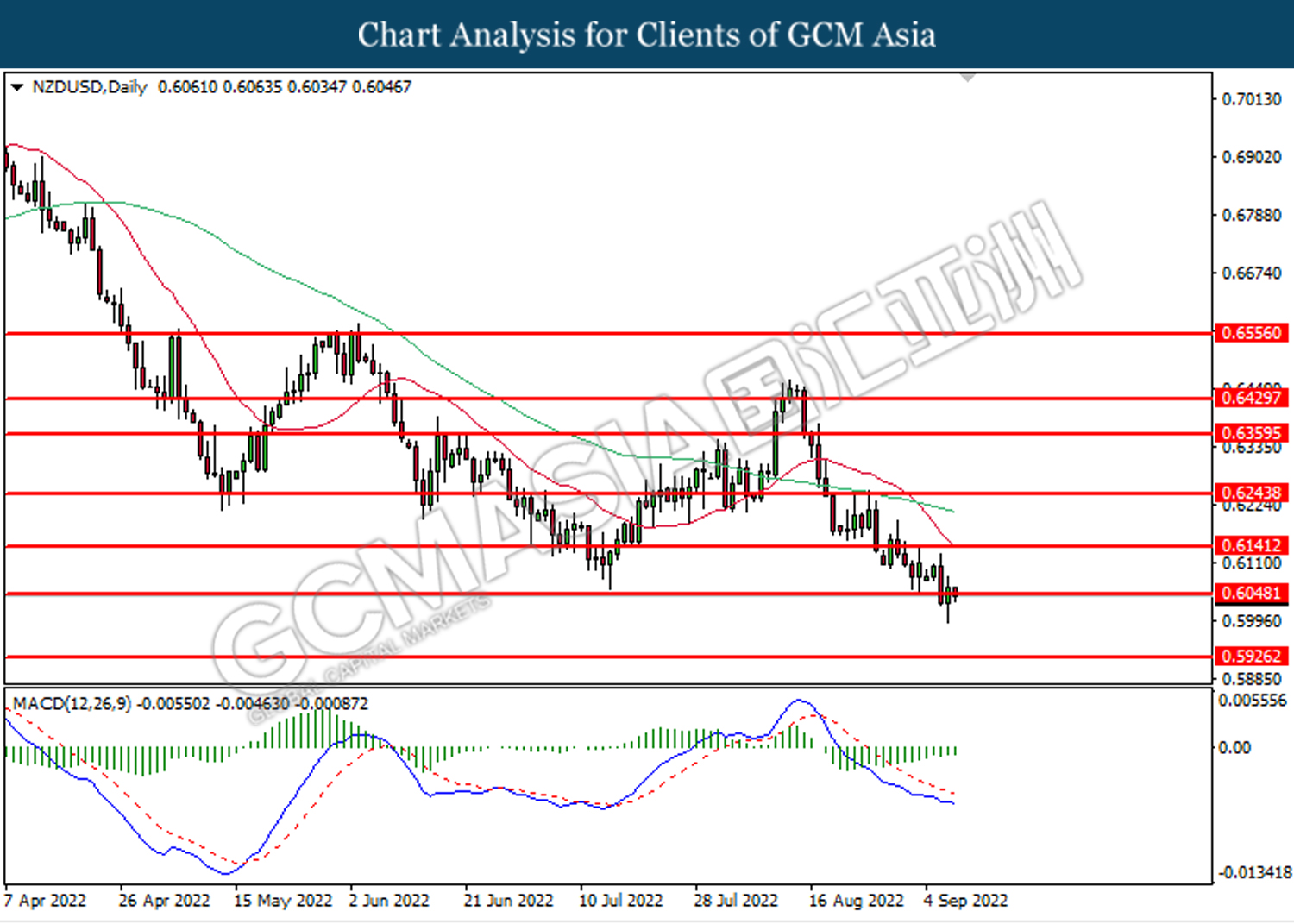

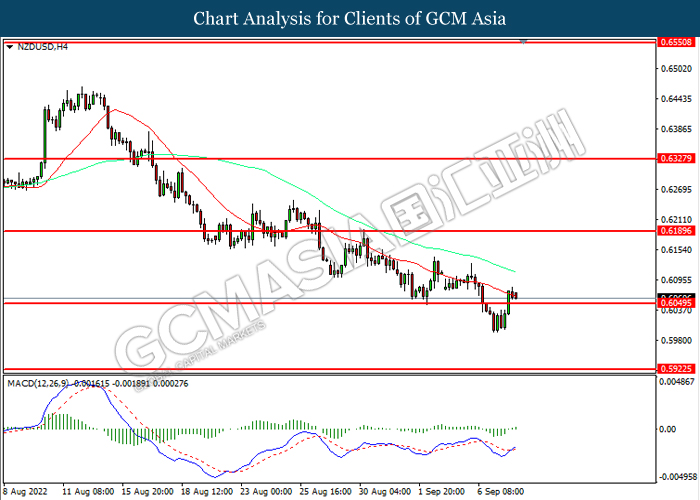

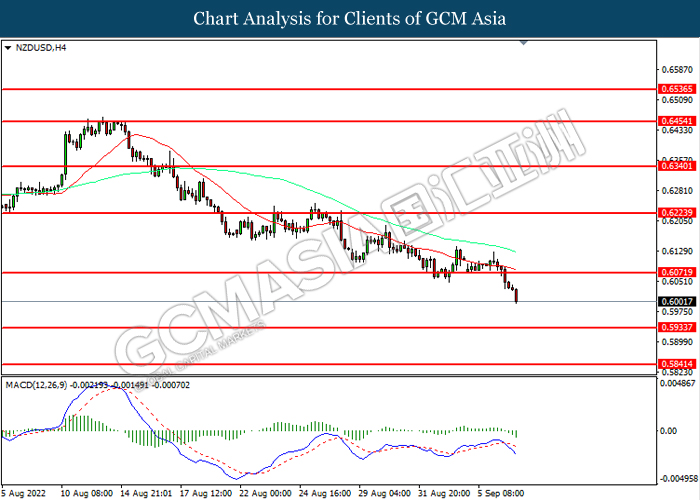

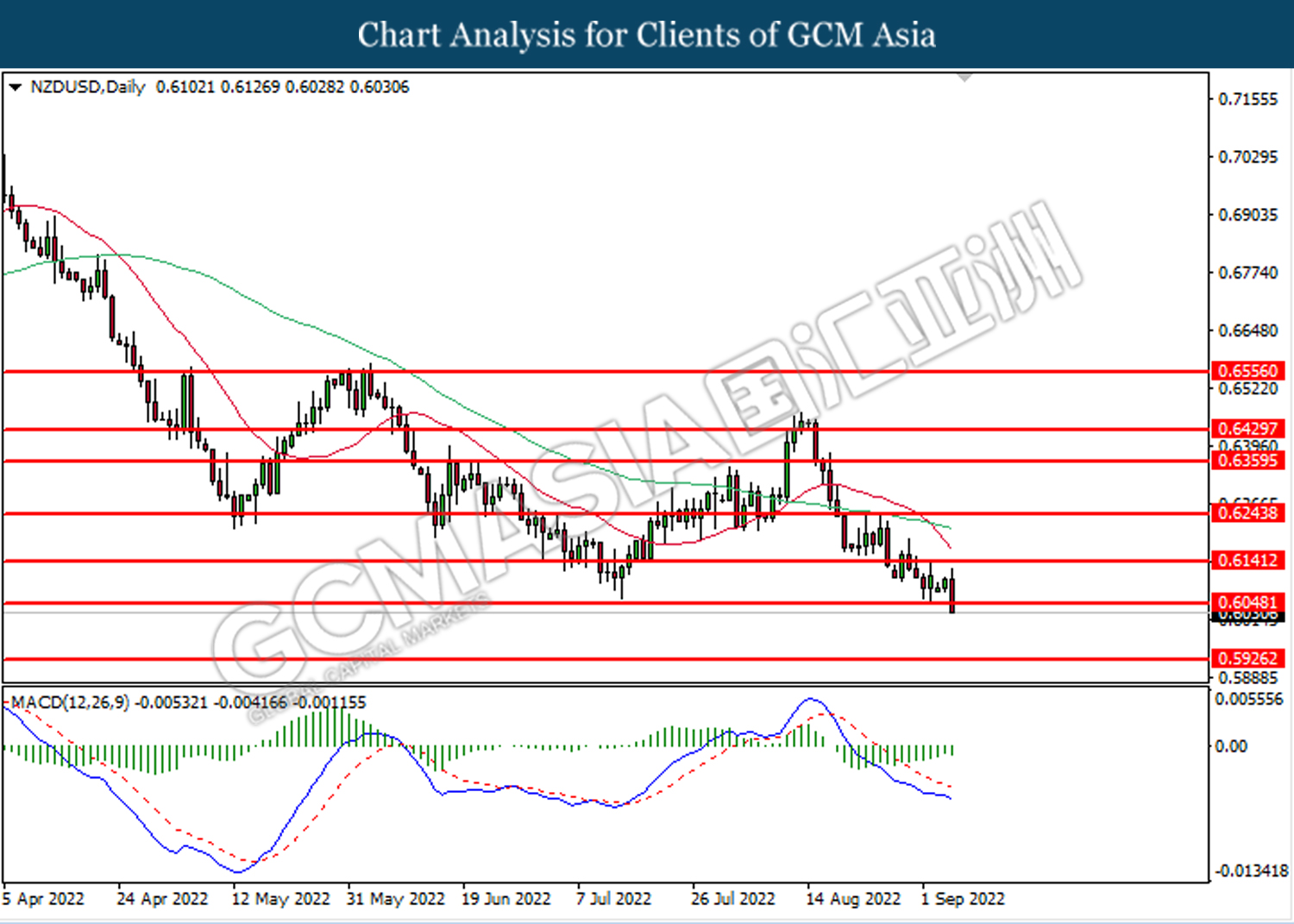

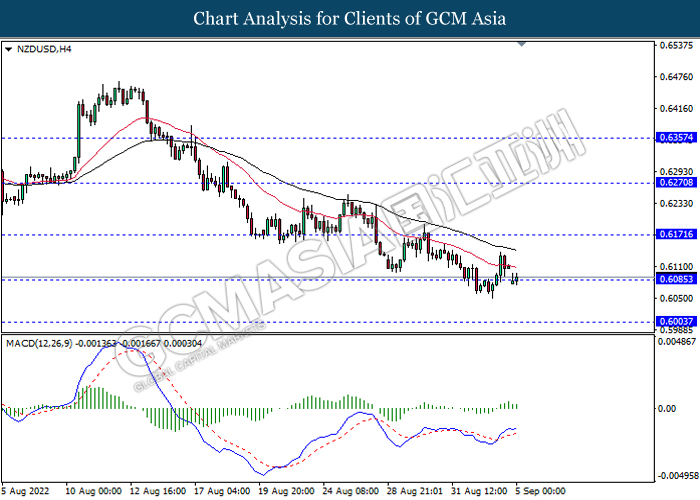

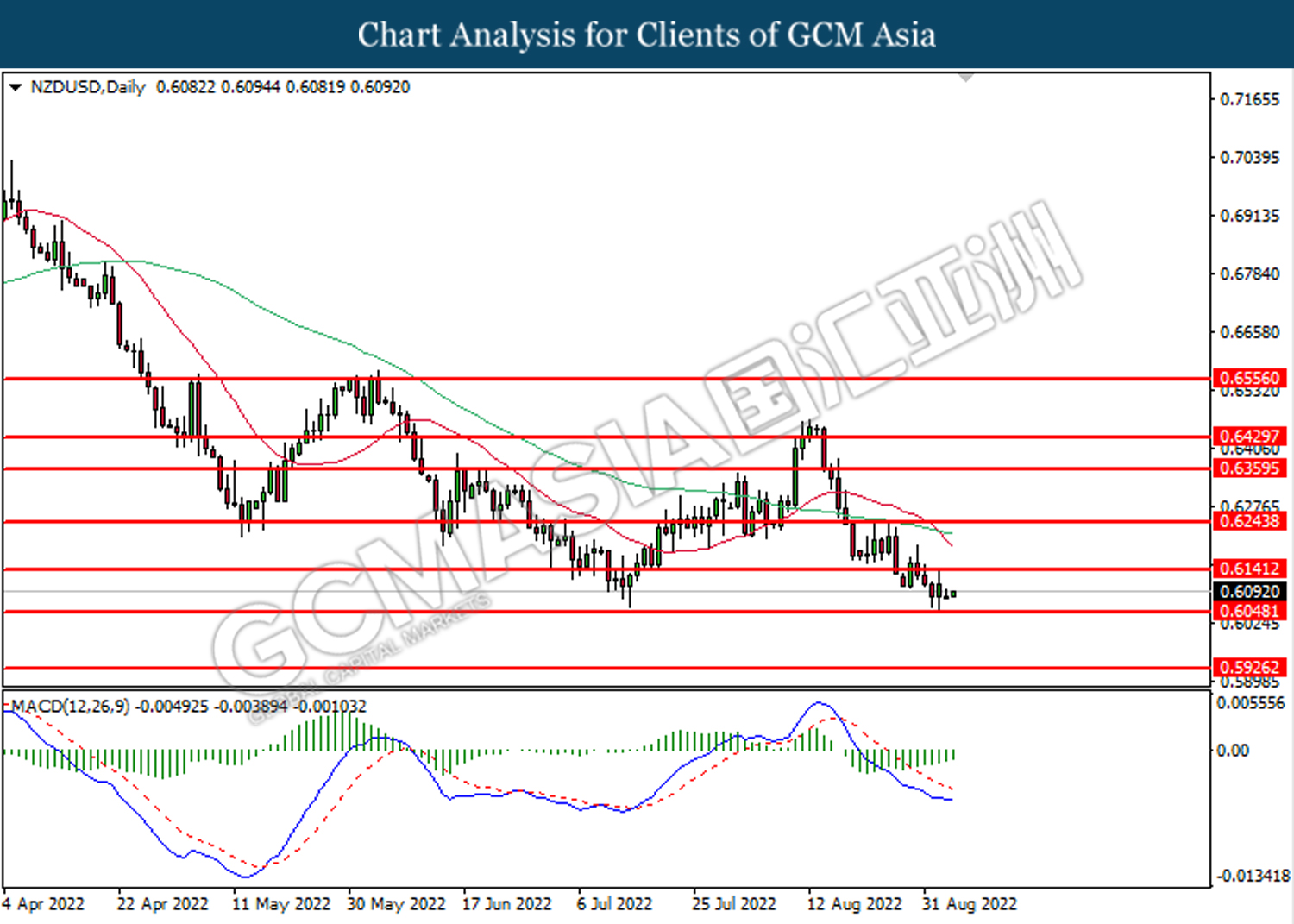

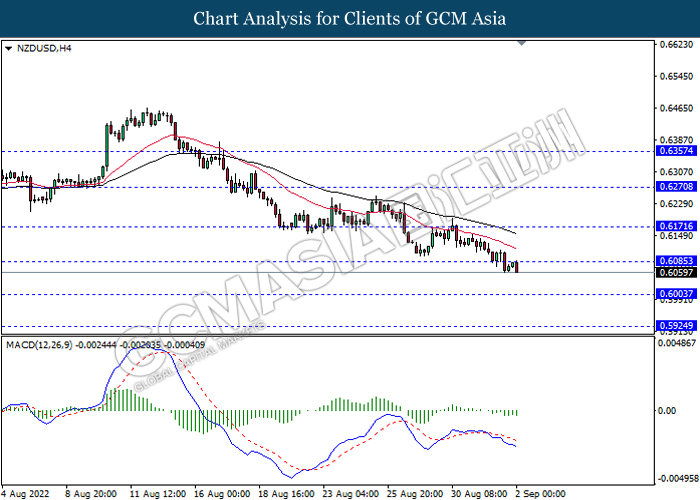

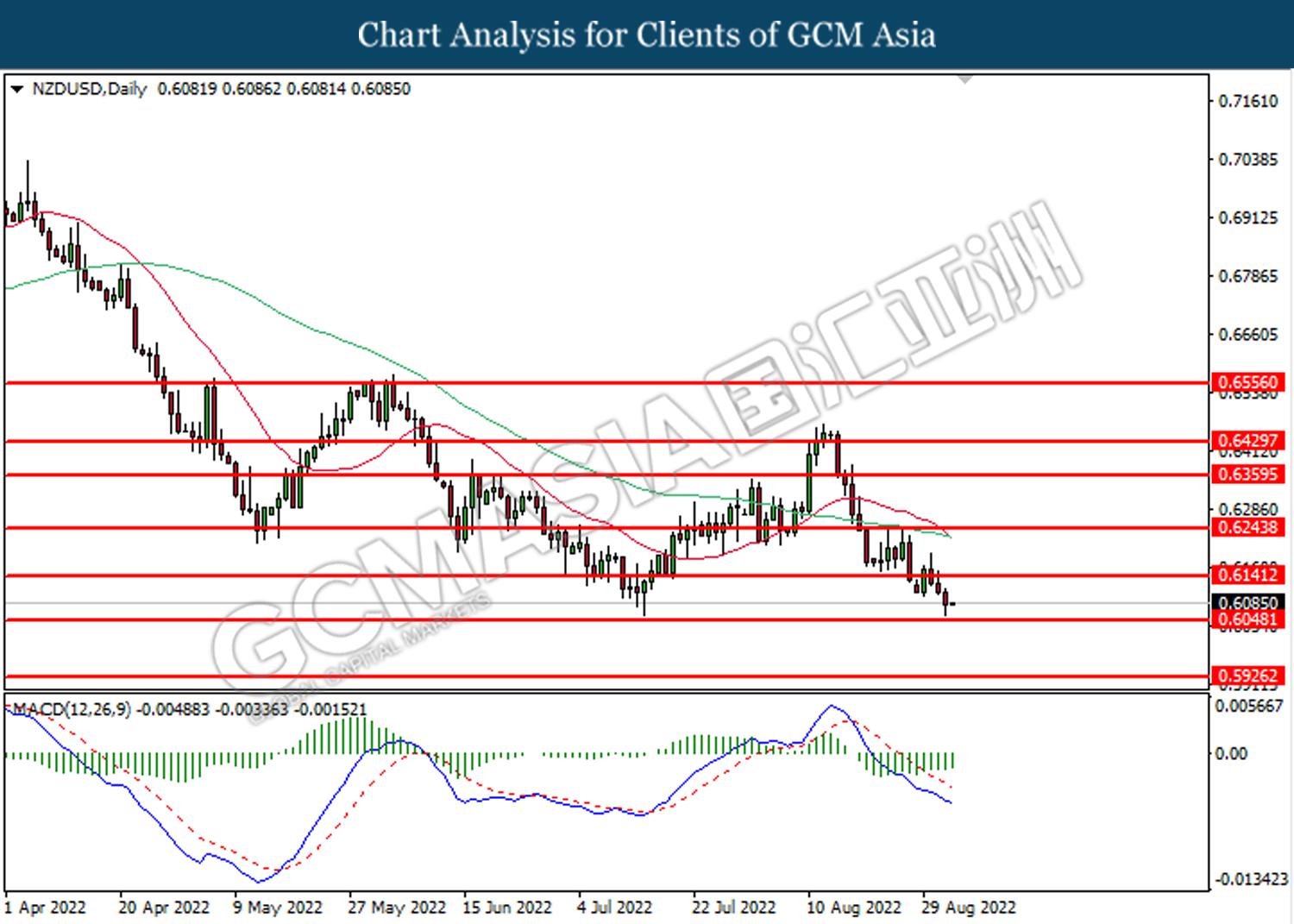

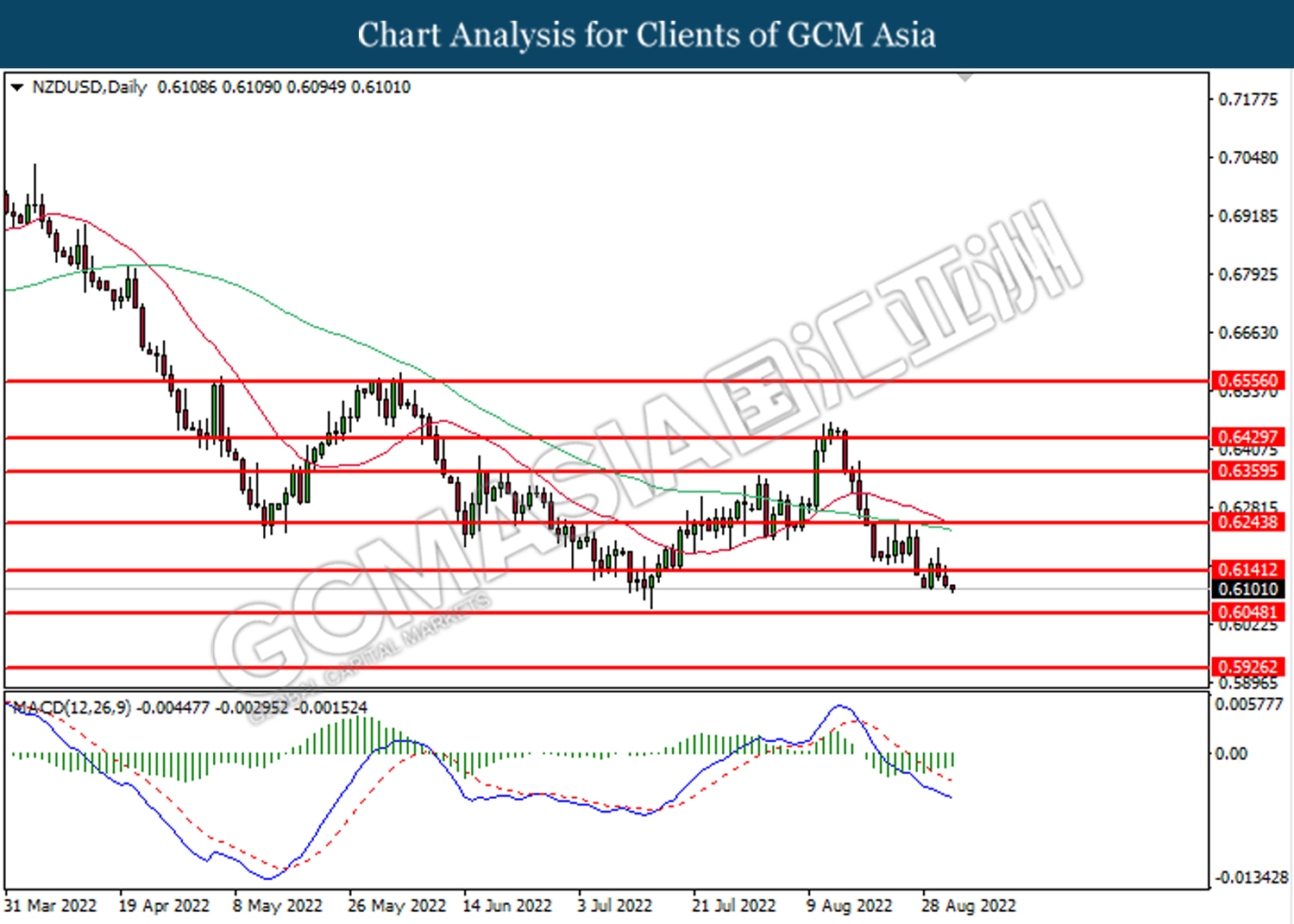

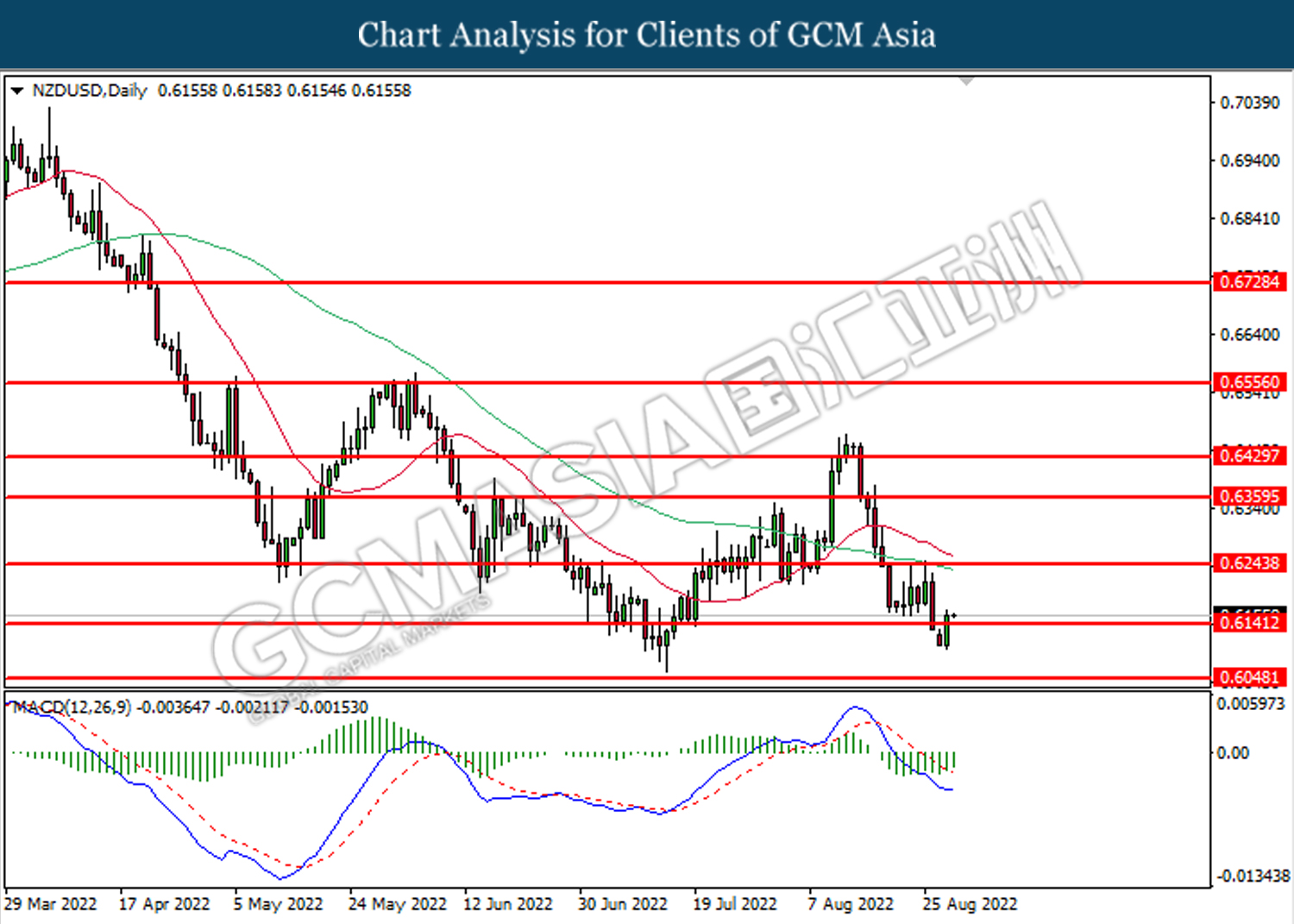

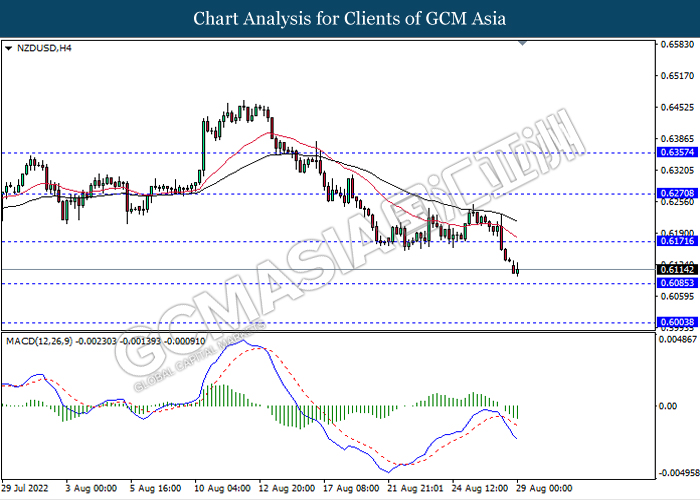

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

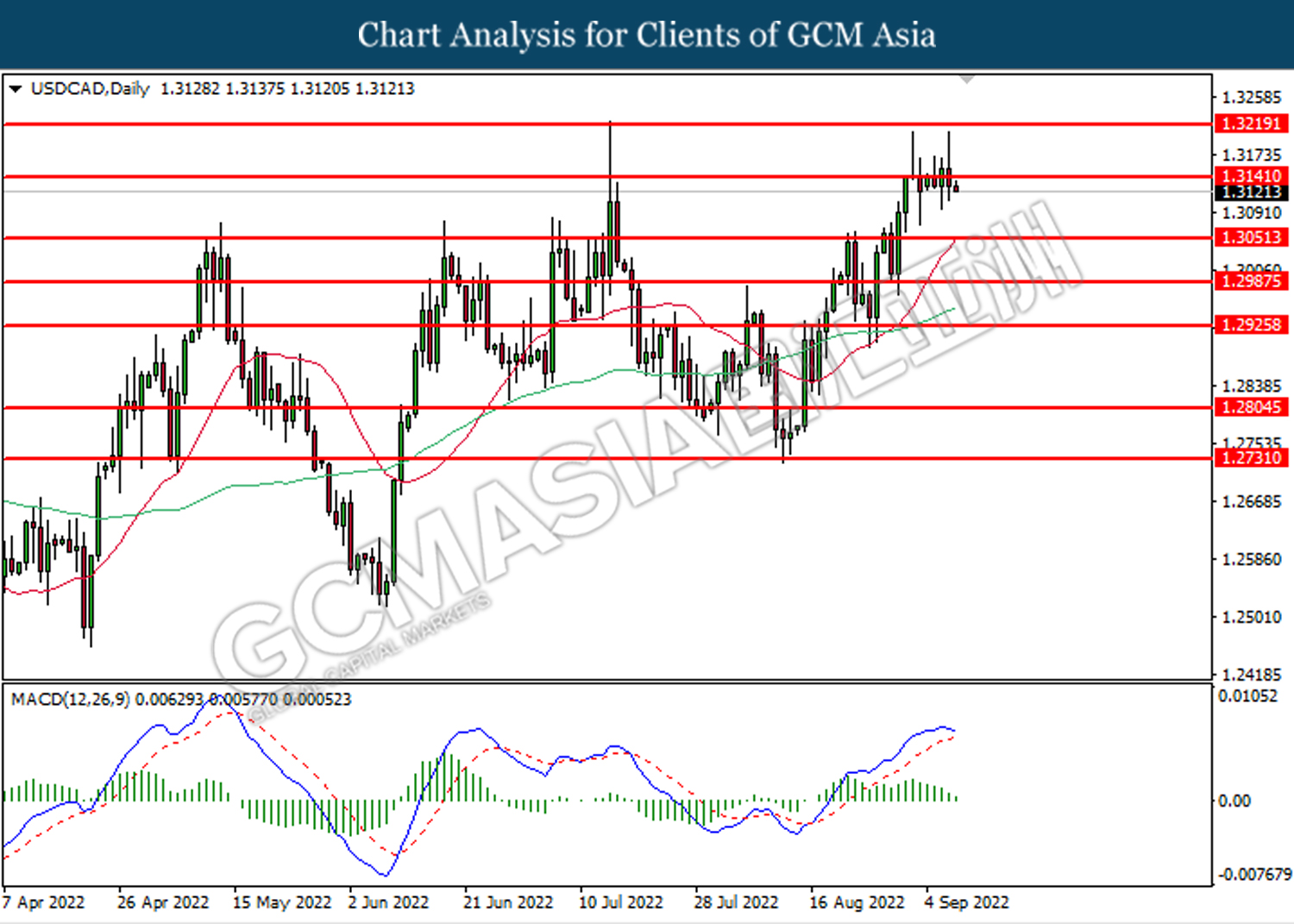

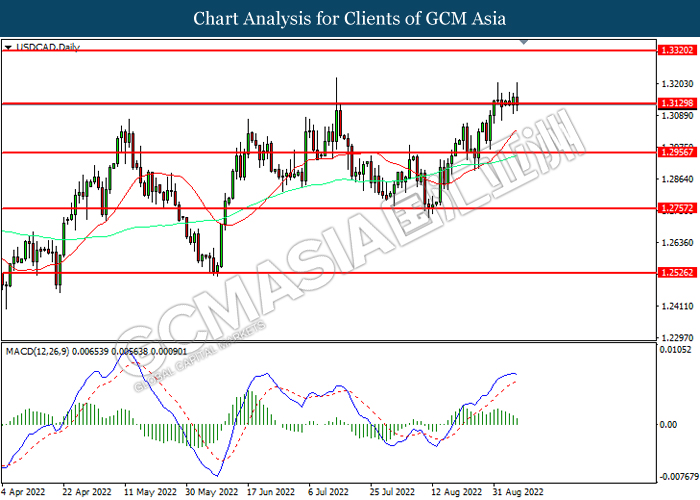

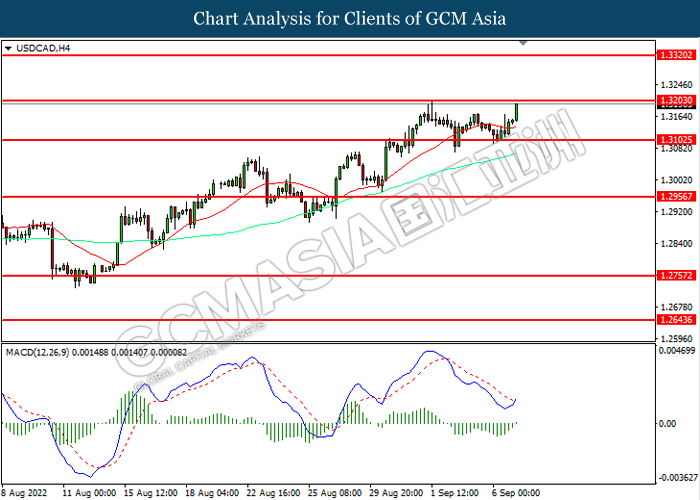

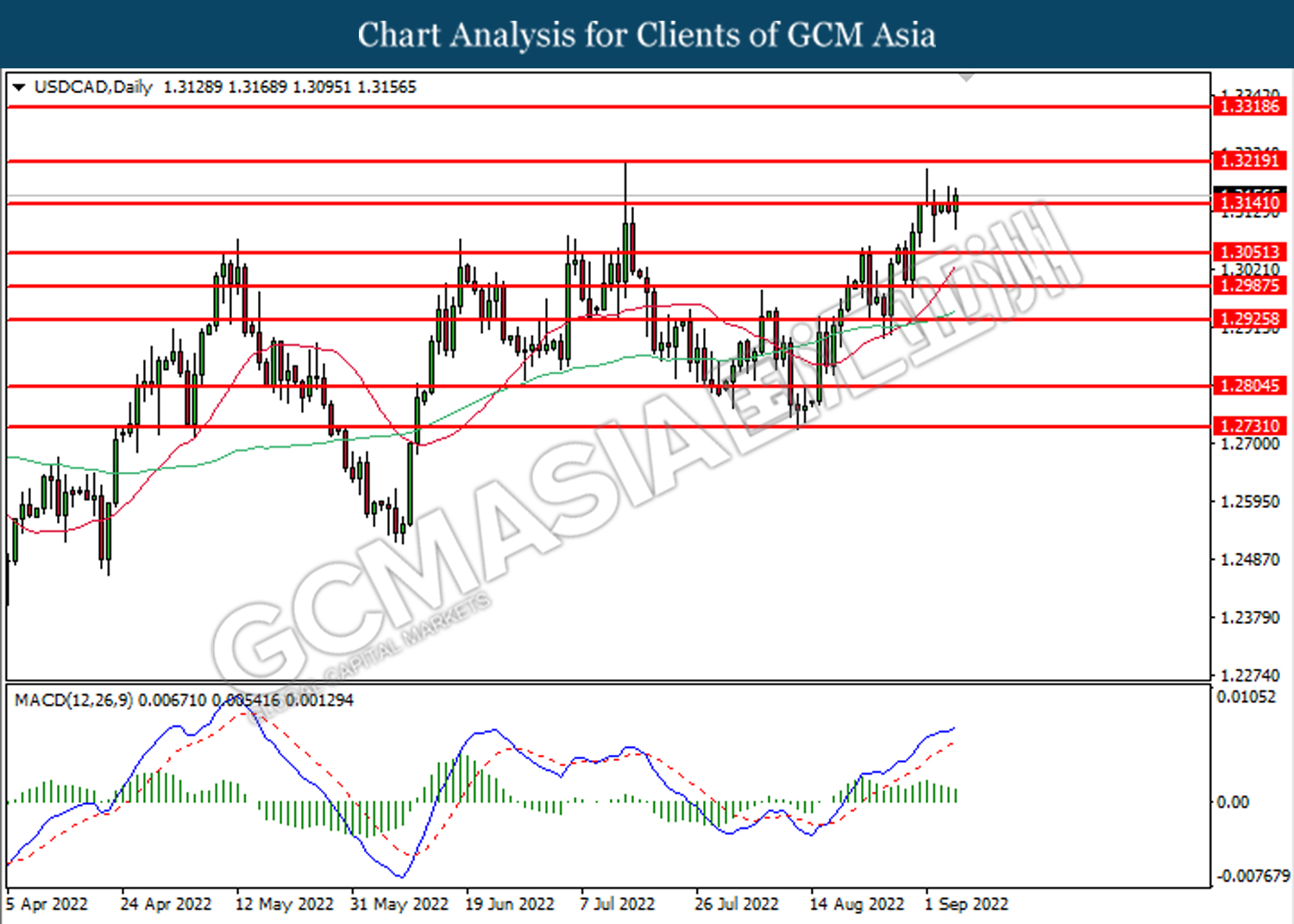

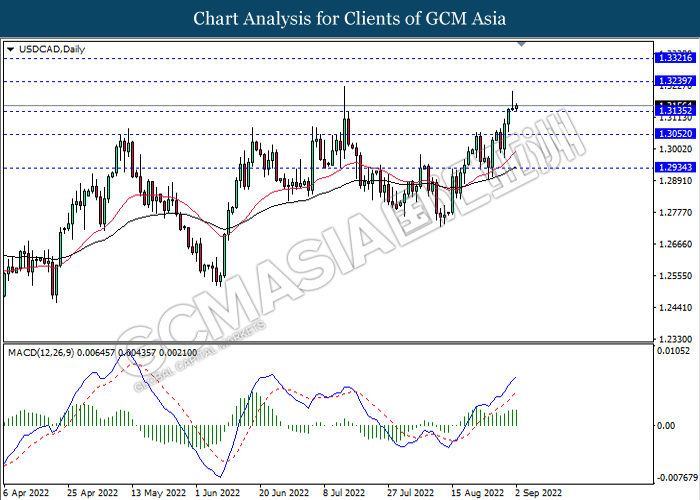

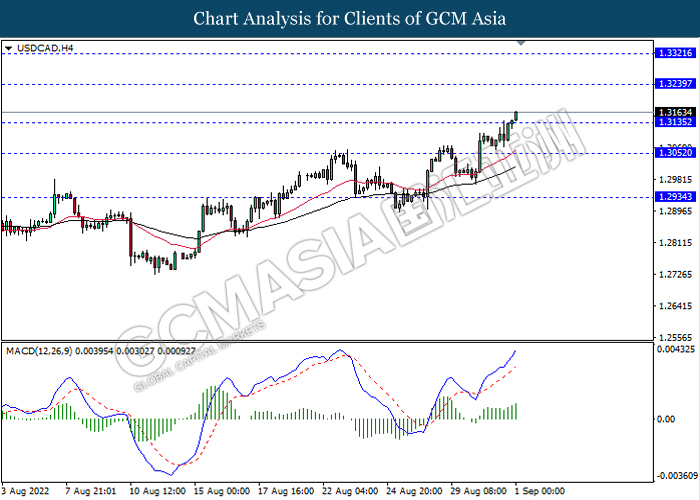

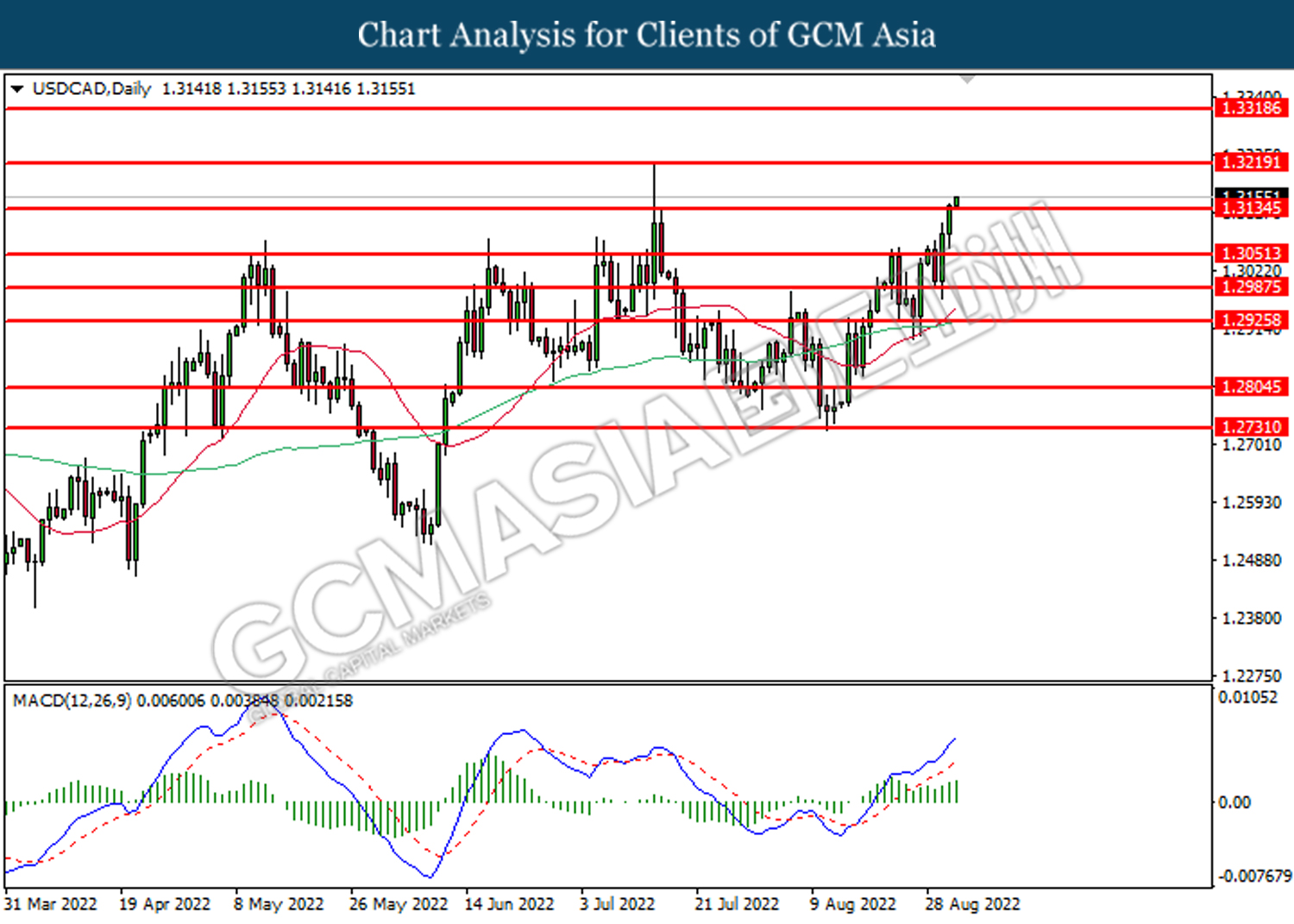

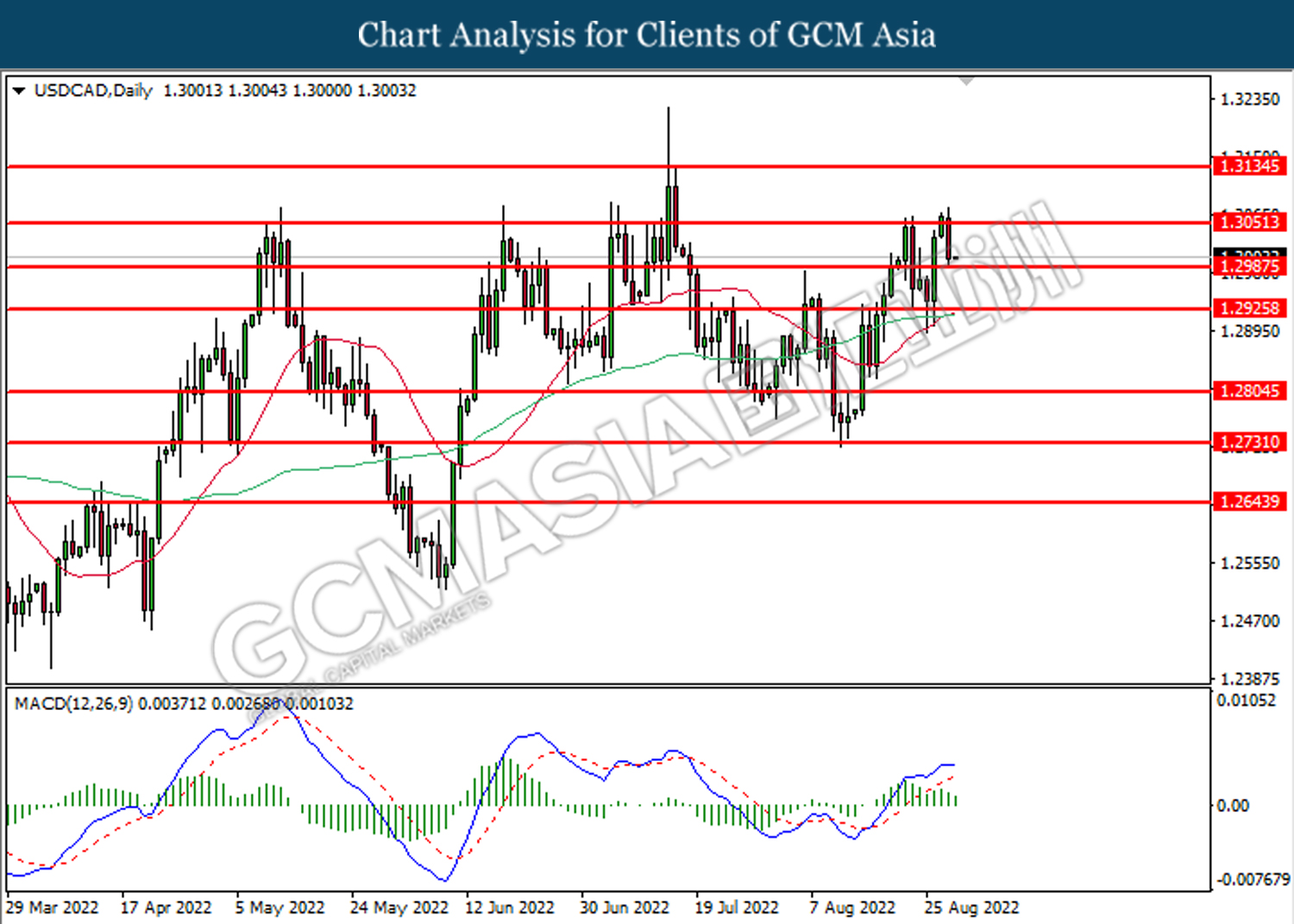

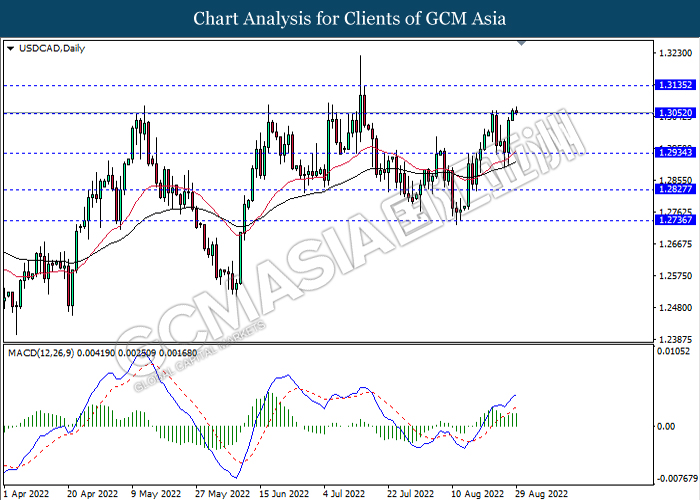

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3140. MACD which illustrated diminishing bullish momentum suggests the pair to extend losses toward the support level at 1.3050.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

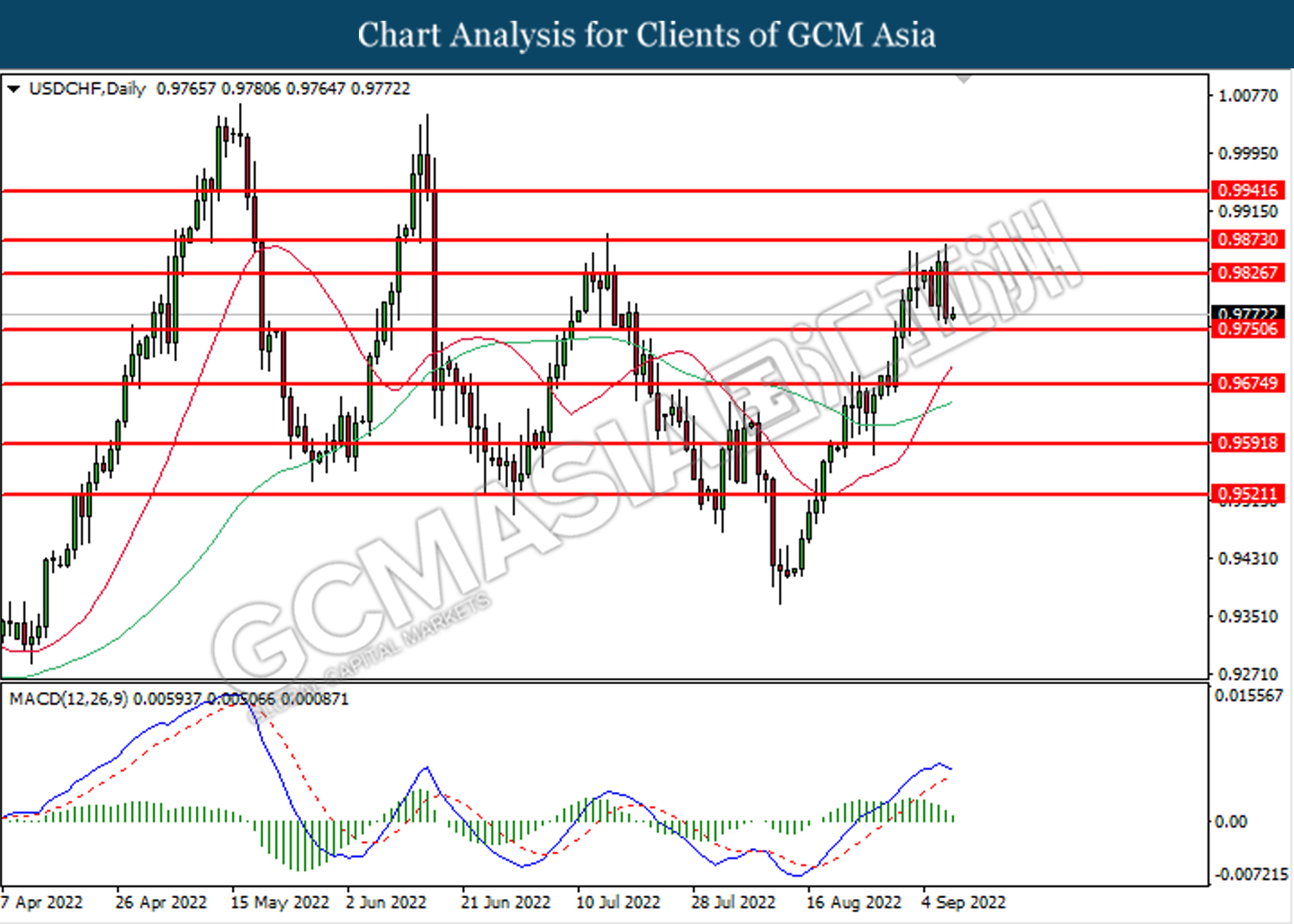

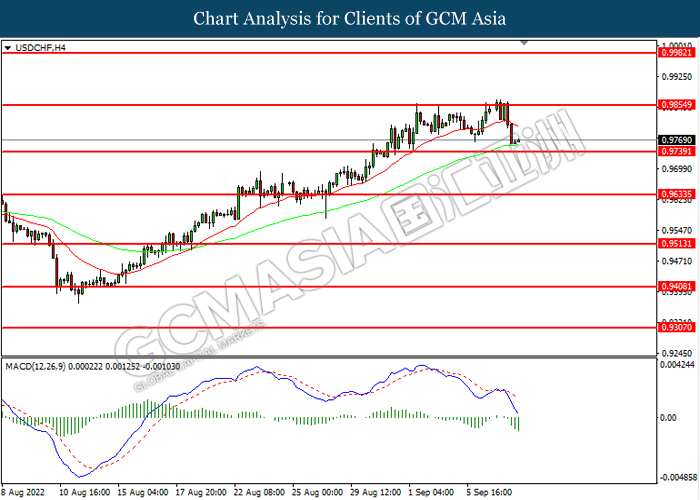

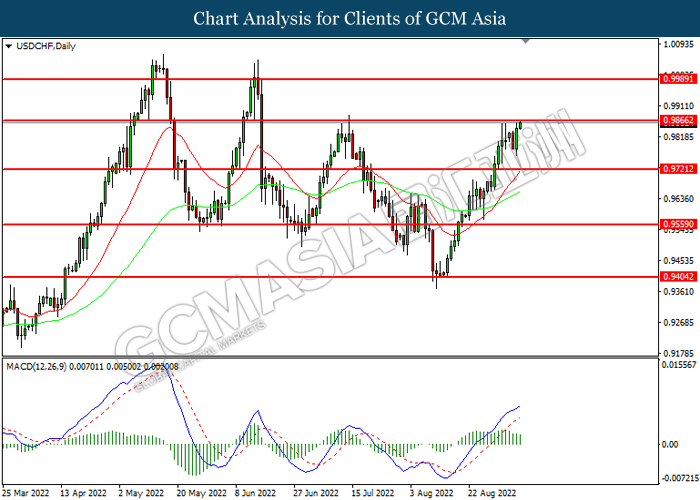

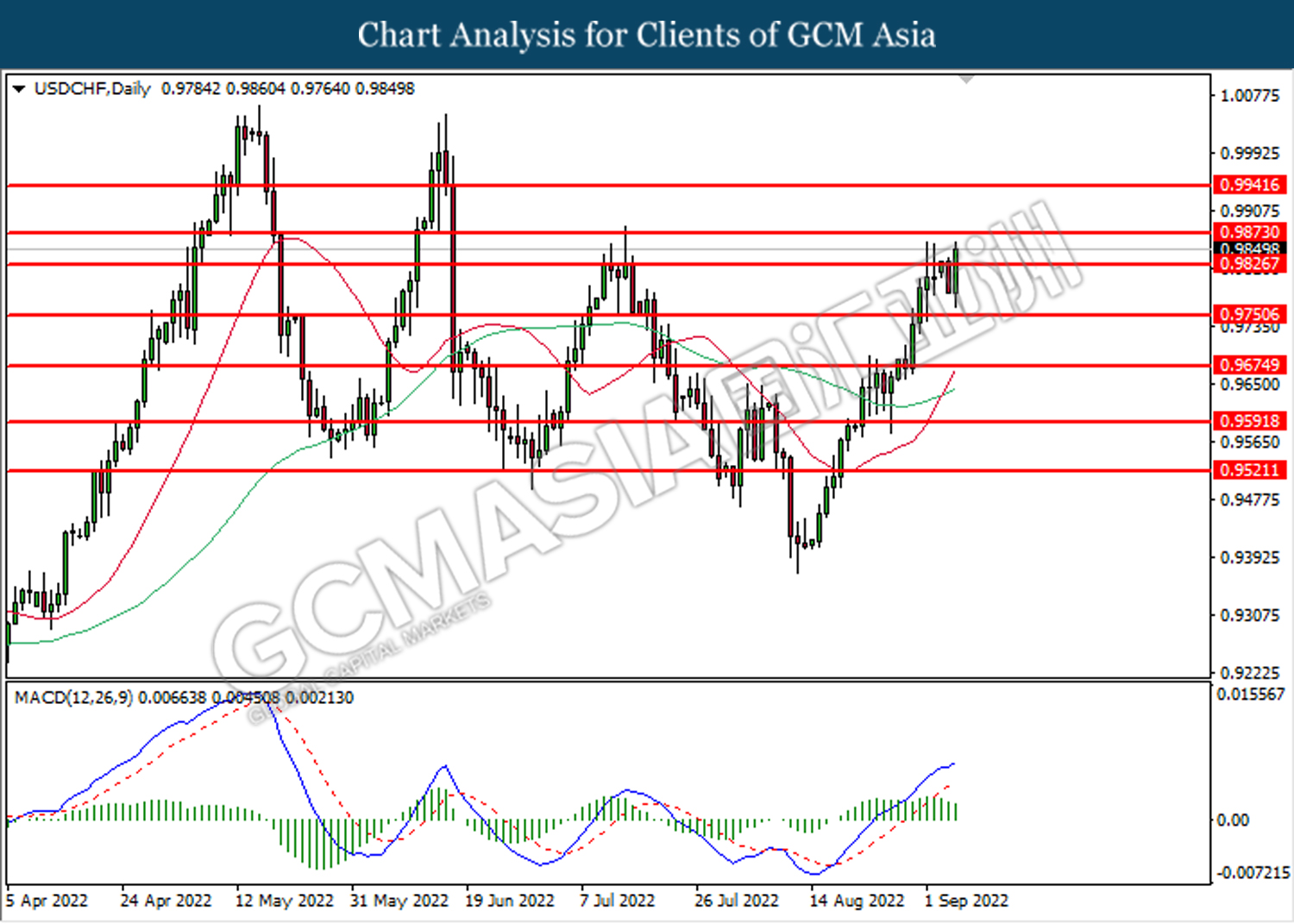

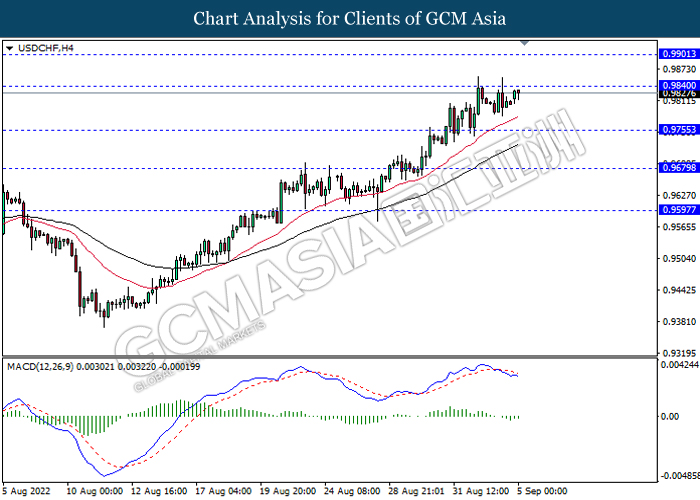

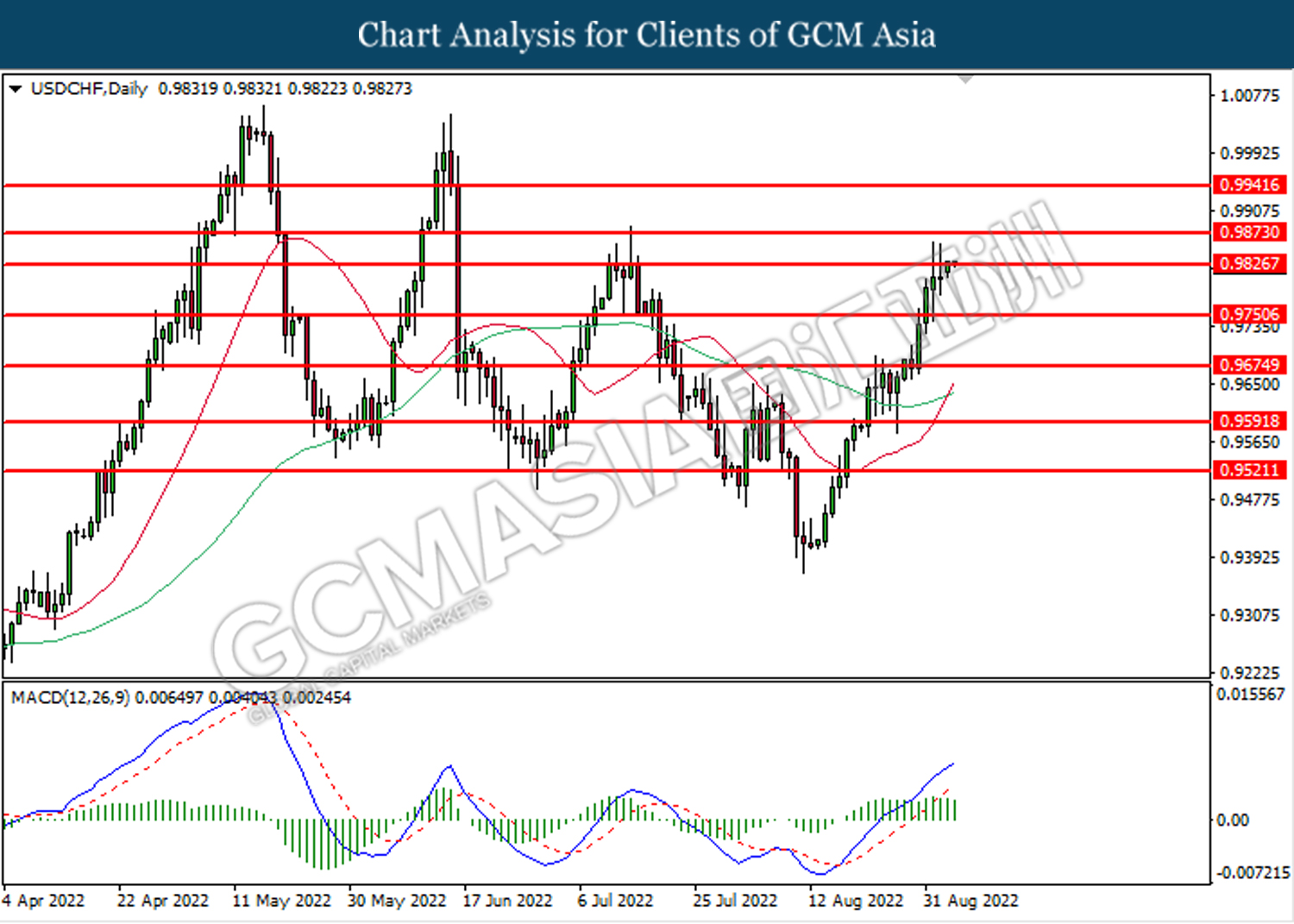

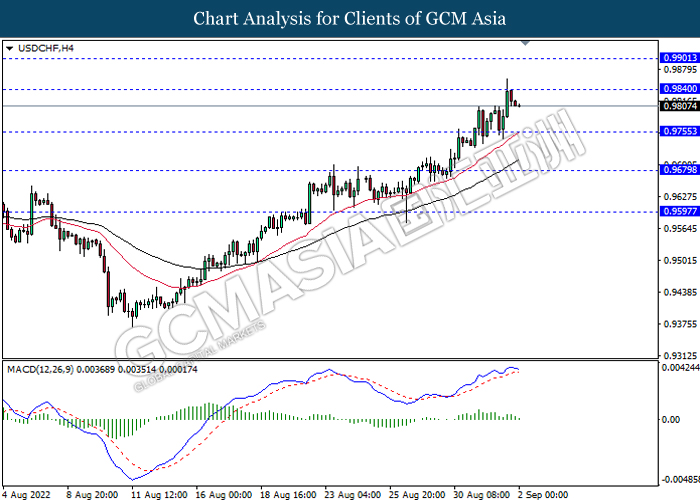

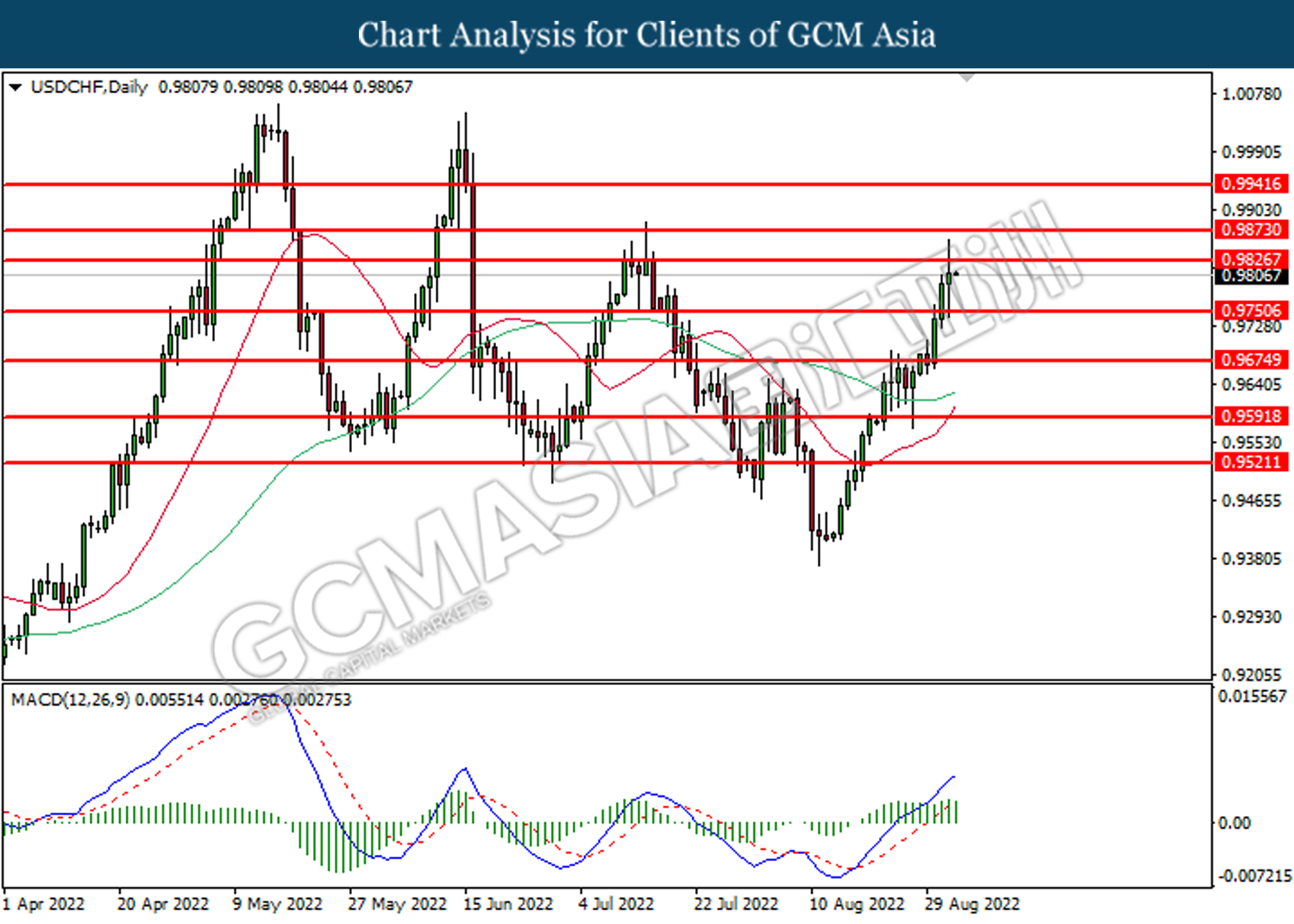

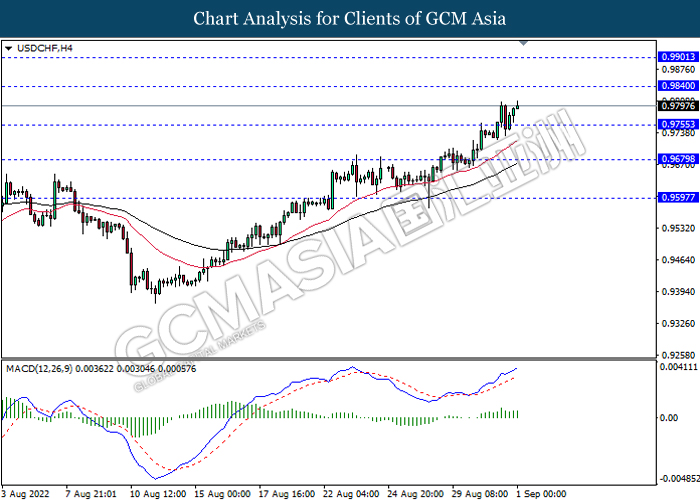

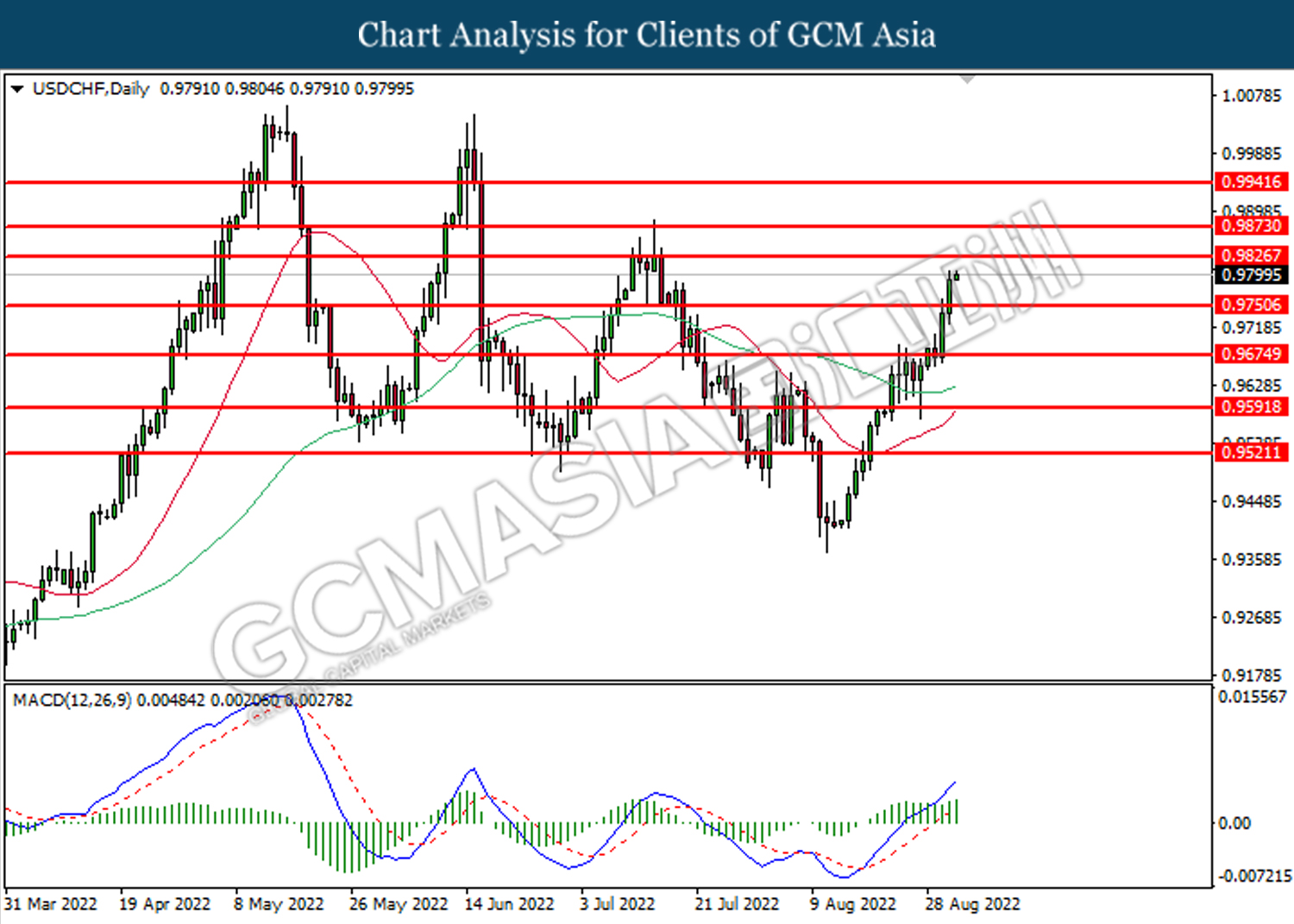

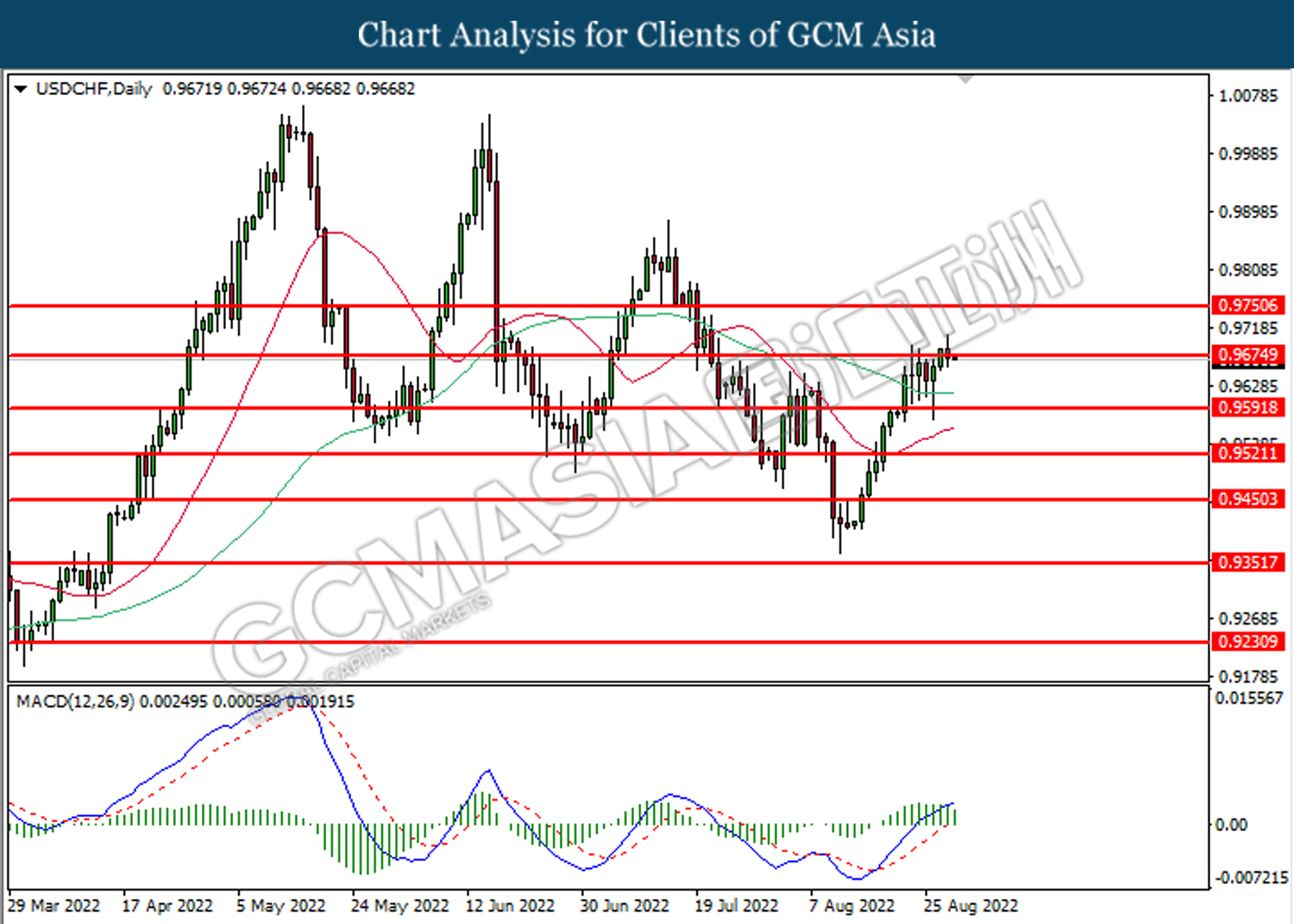

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9825. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9750.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

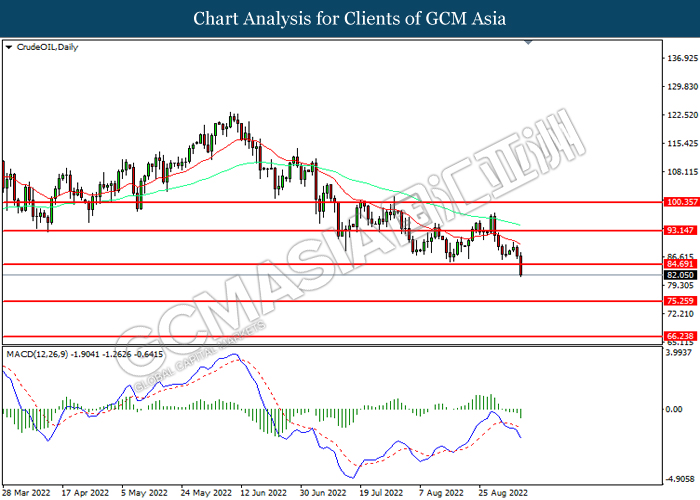

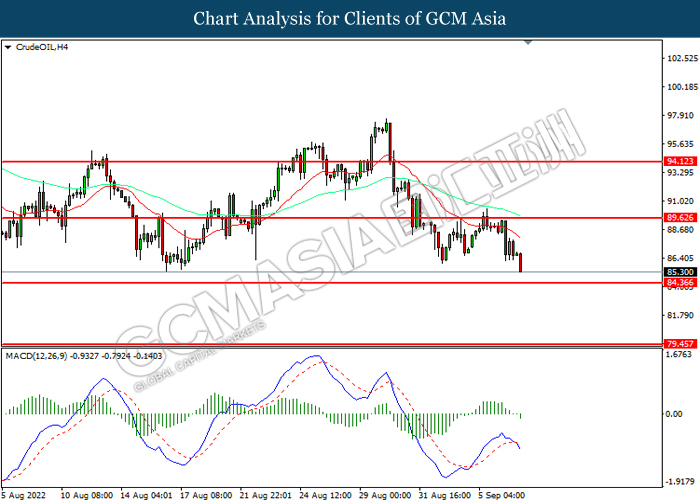

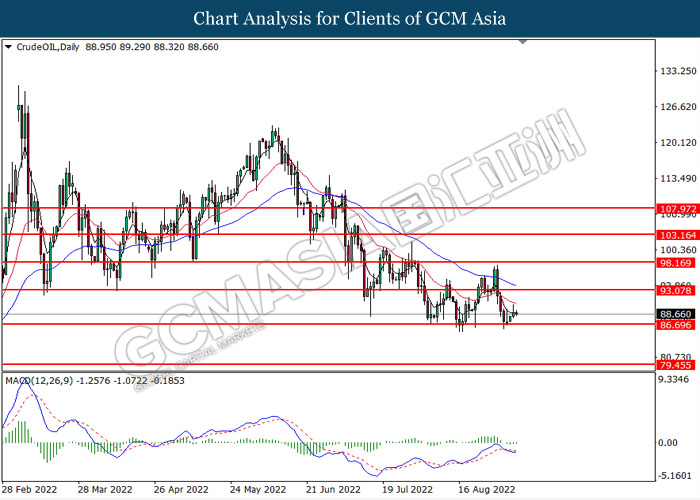

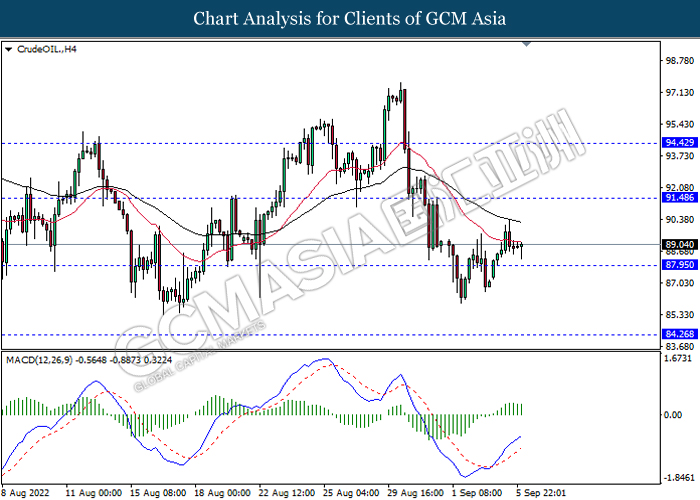

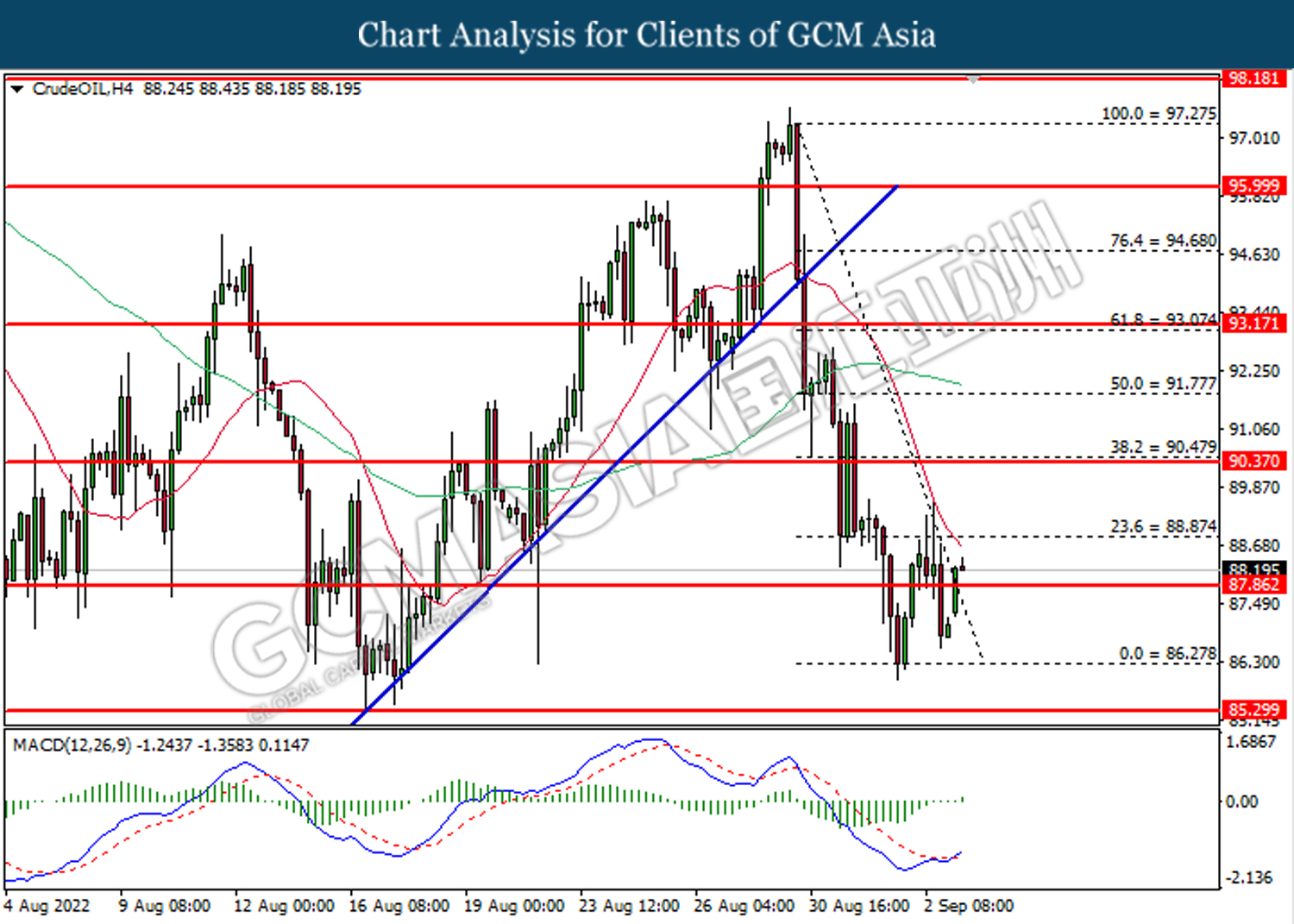

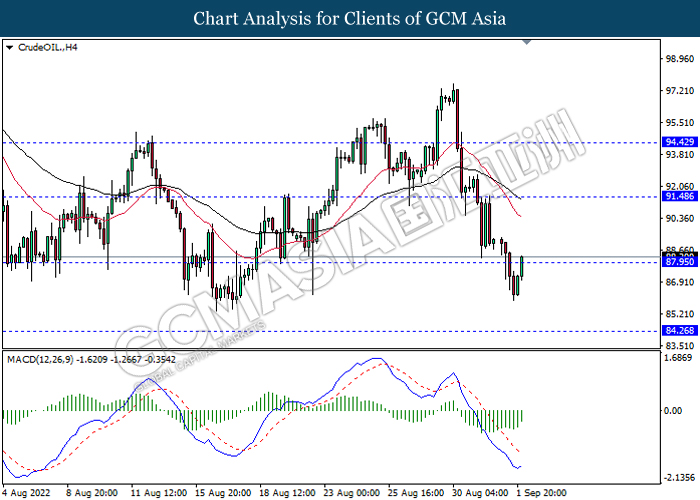

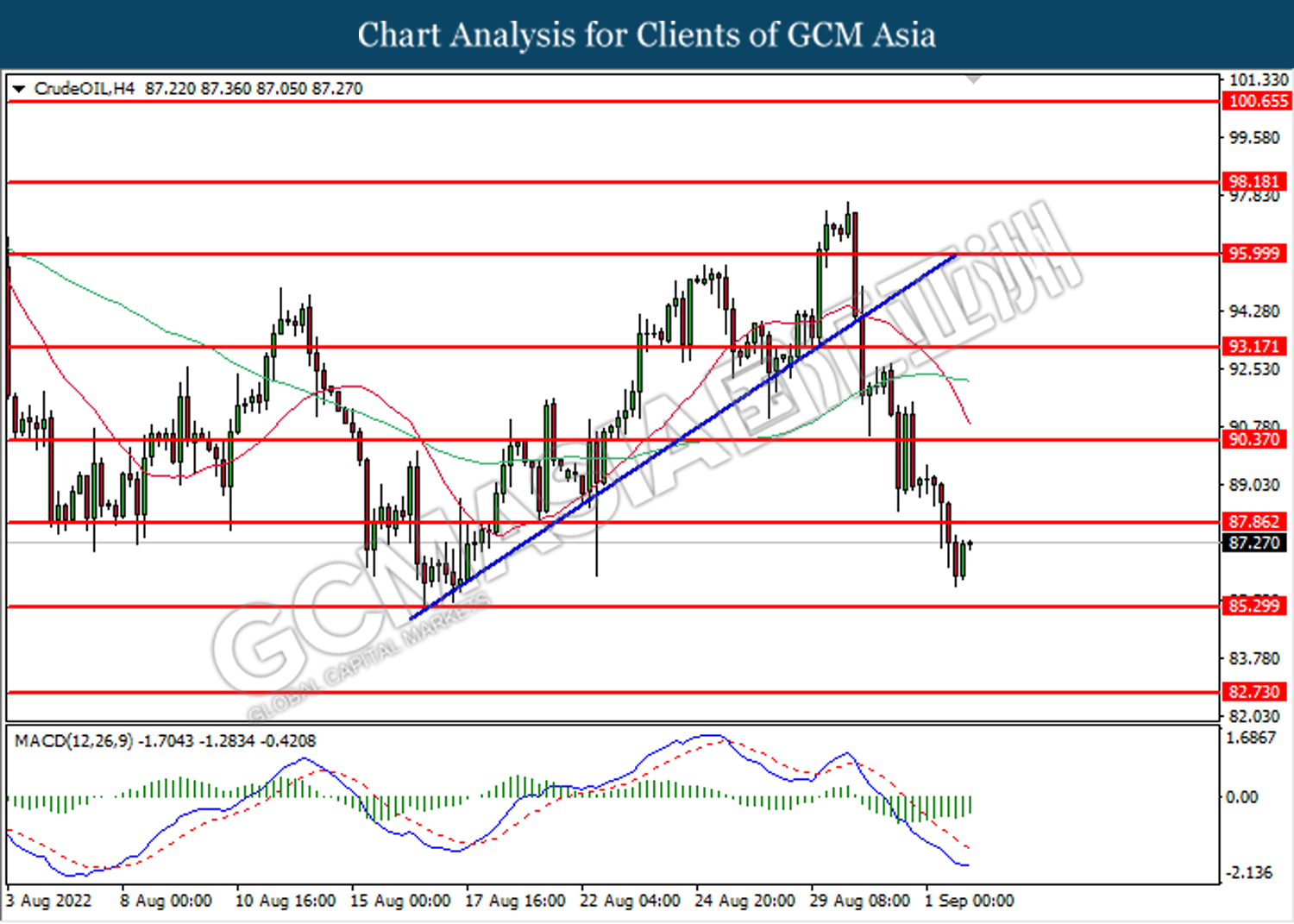

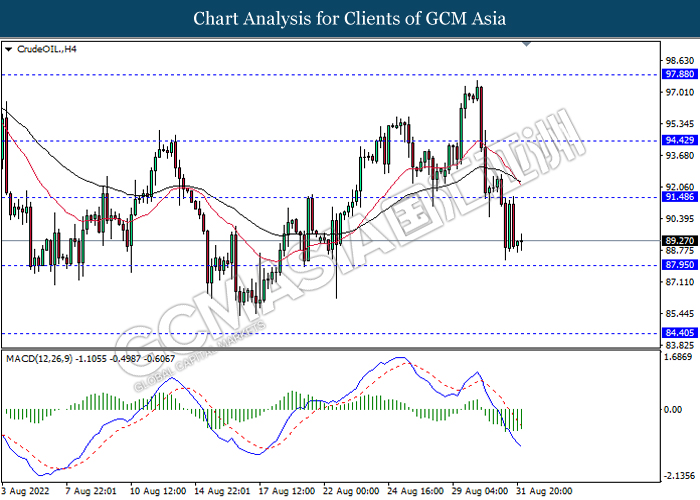

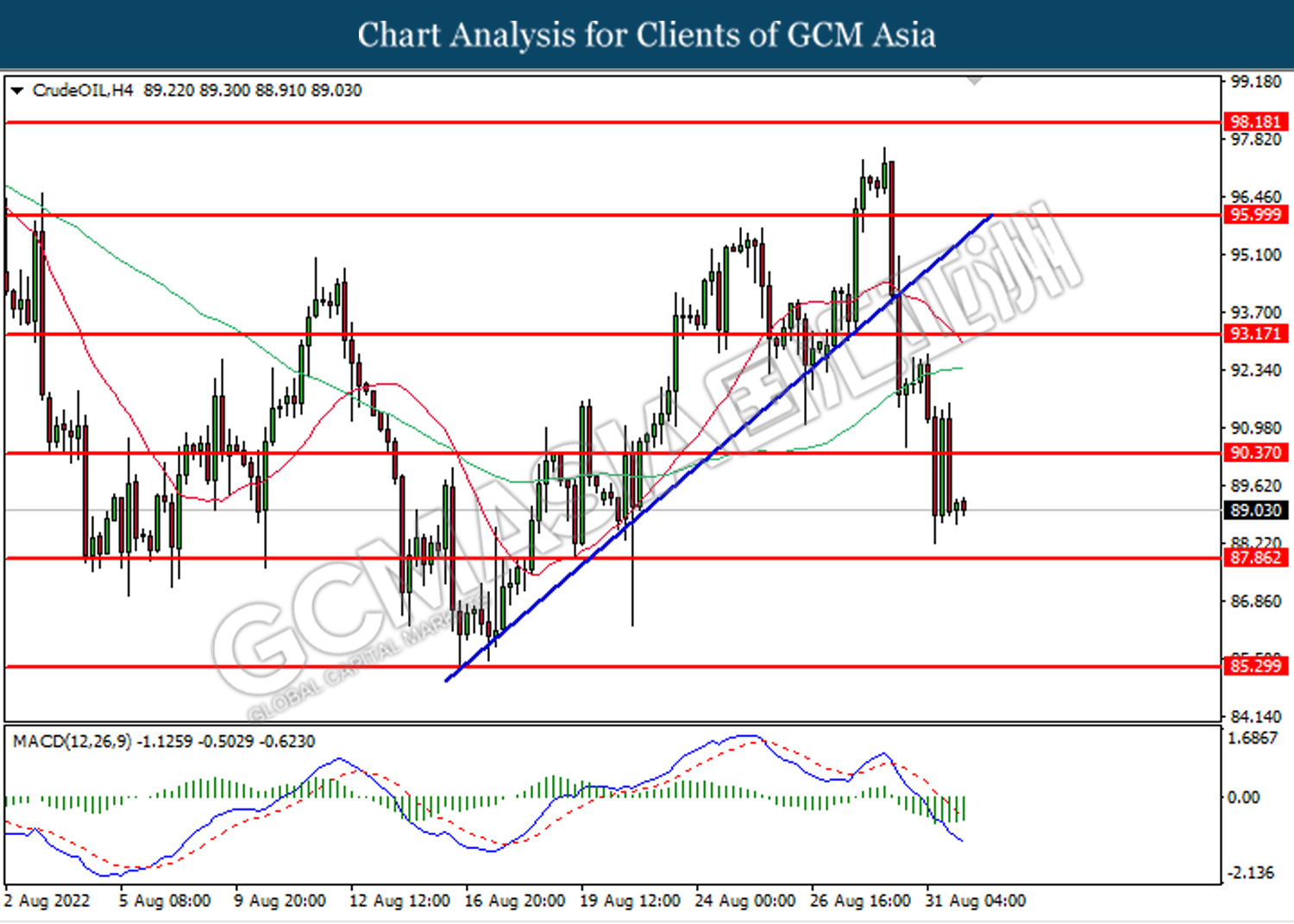

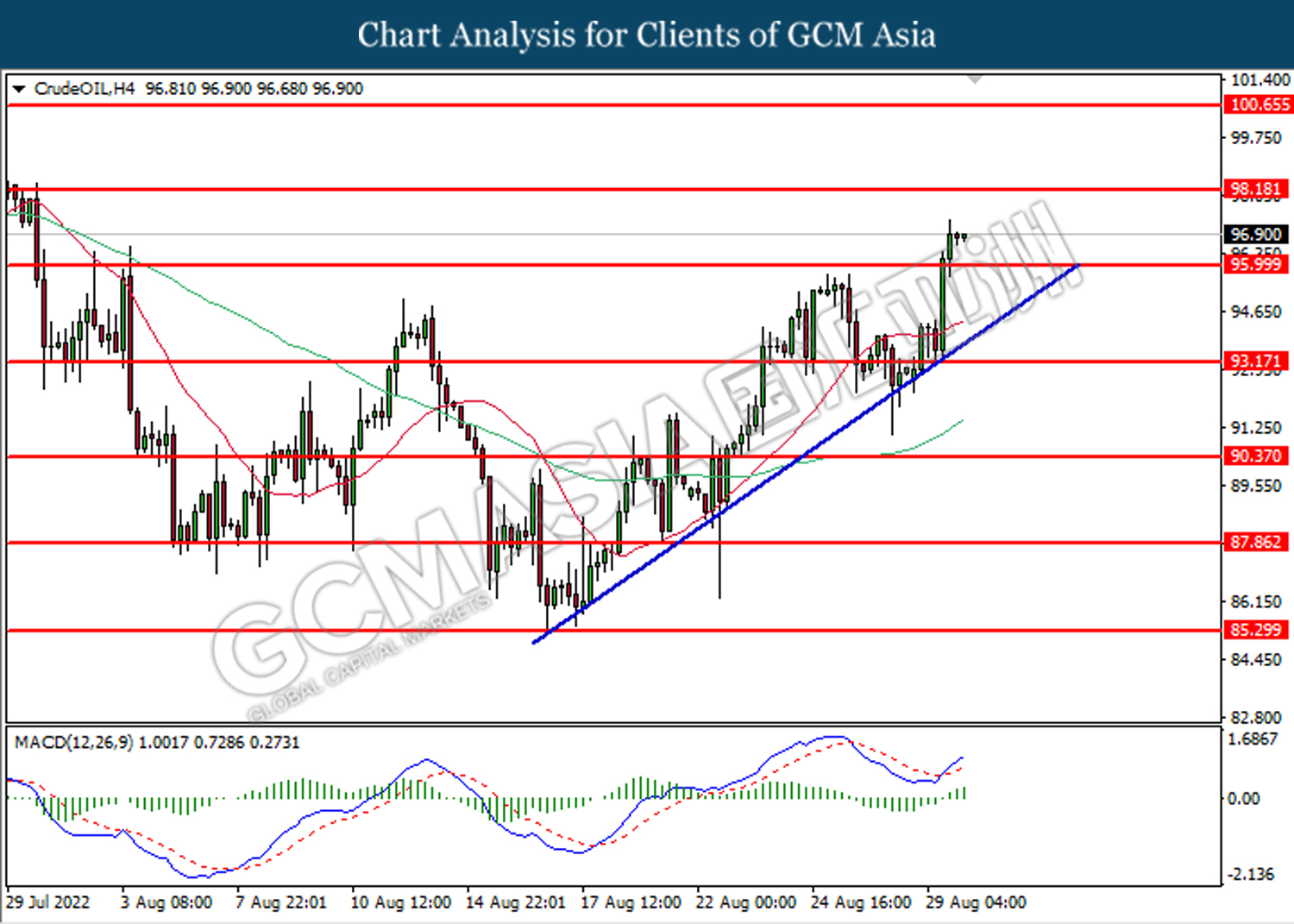

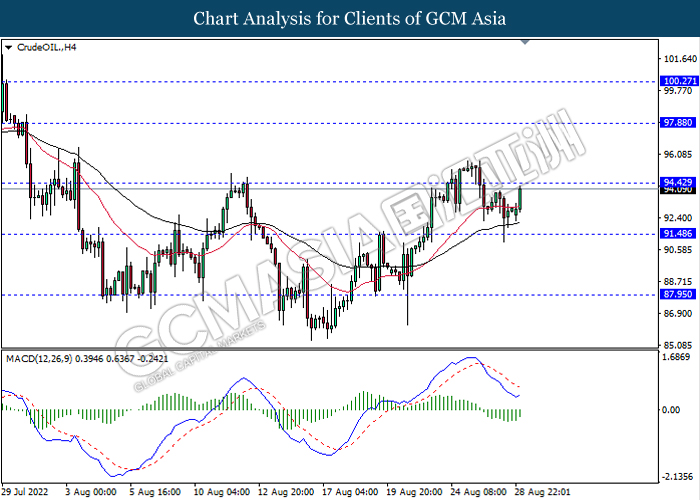

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 83.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 83.50, 86.15

Support level: 80.60, 78.20

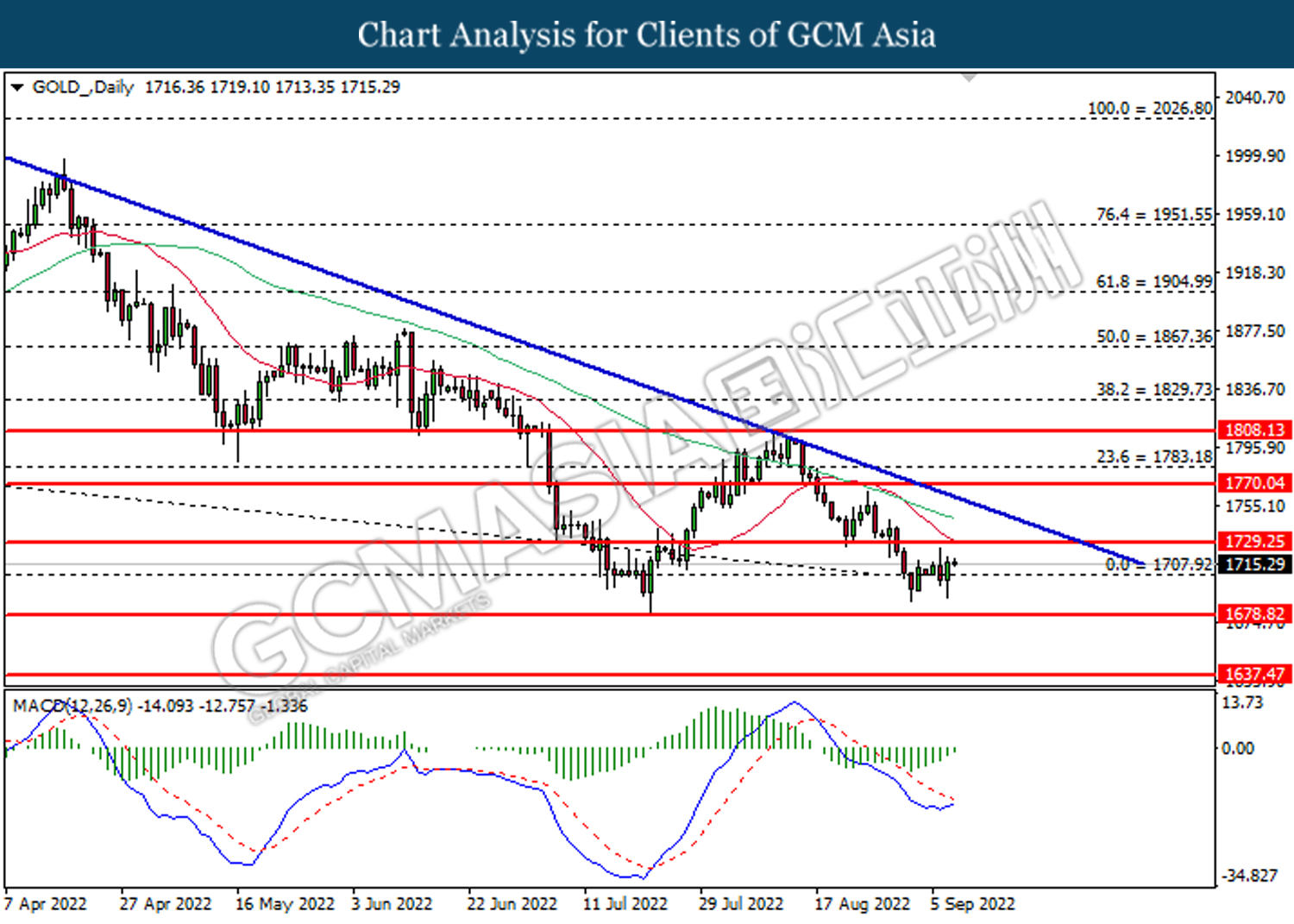

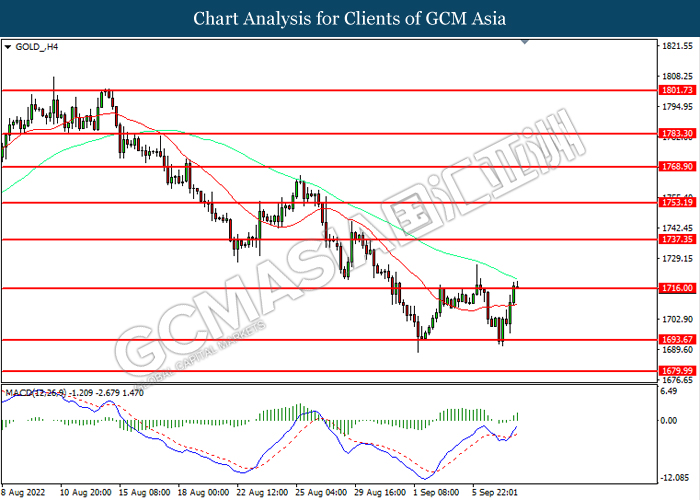

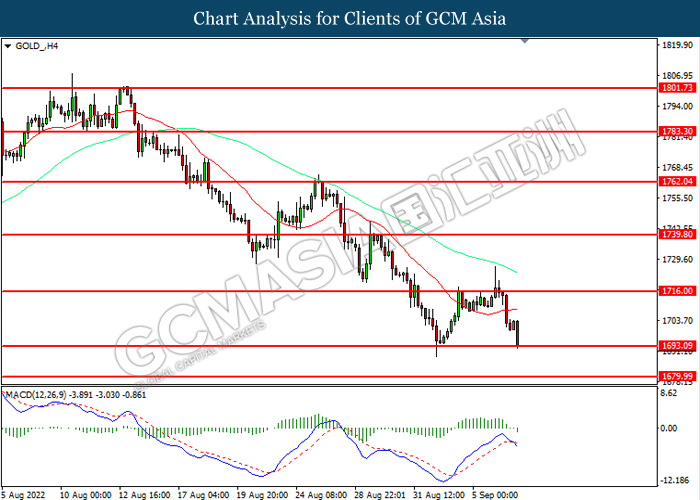

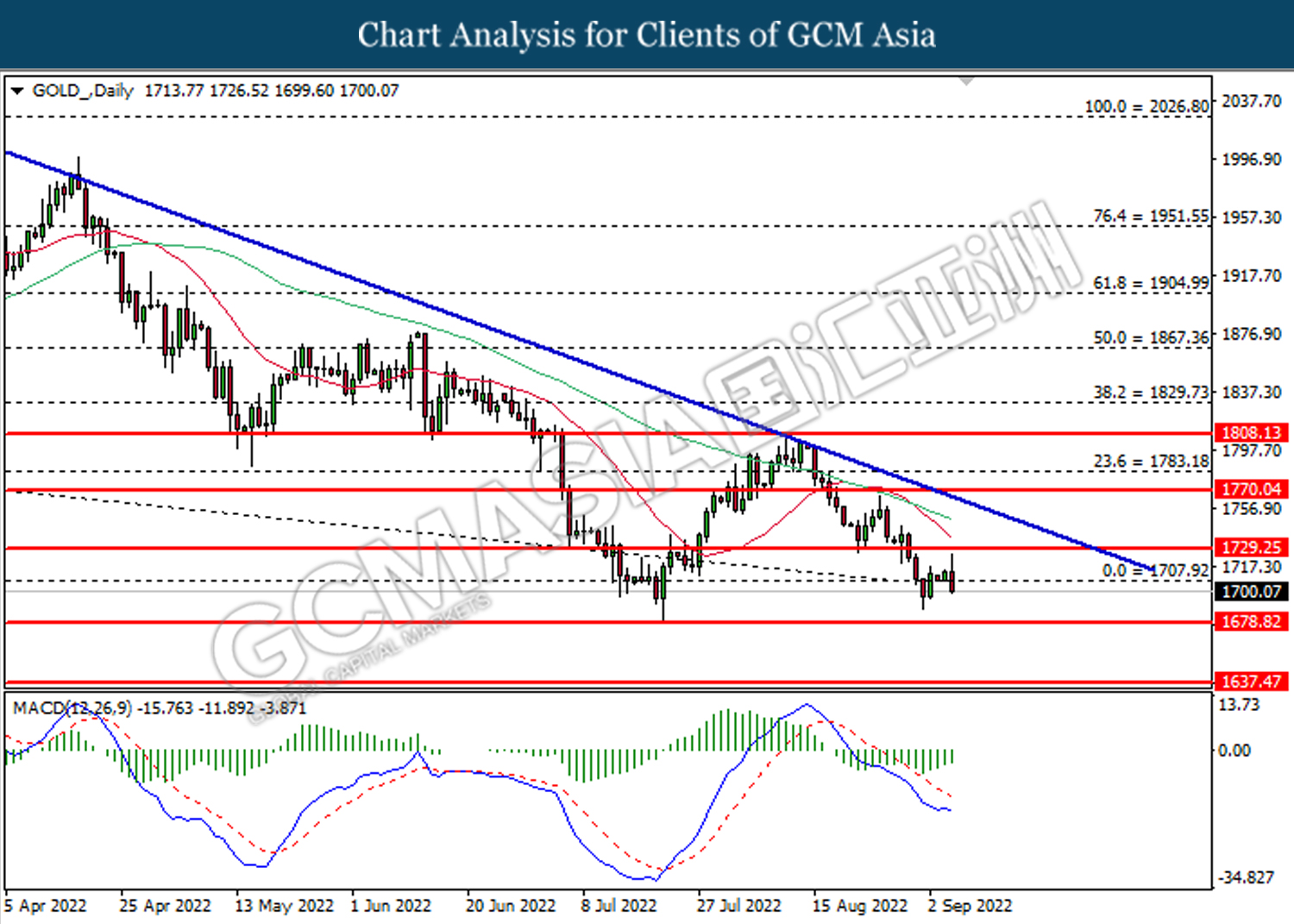

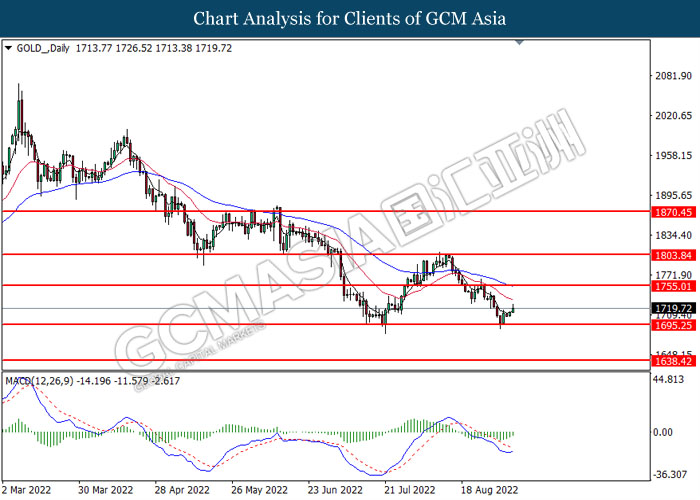

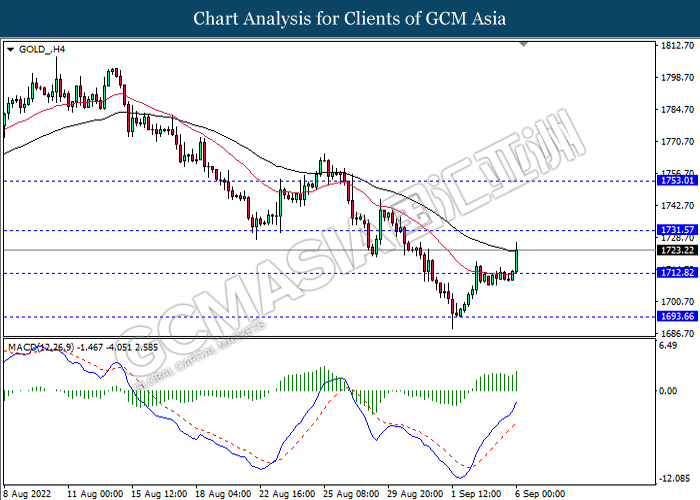

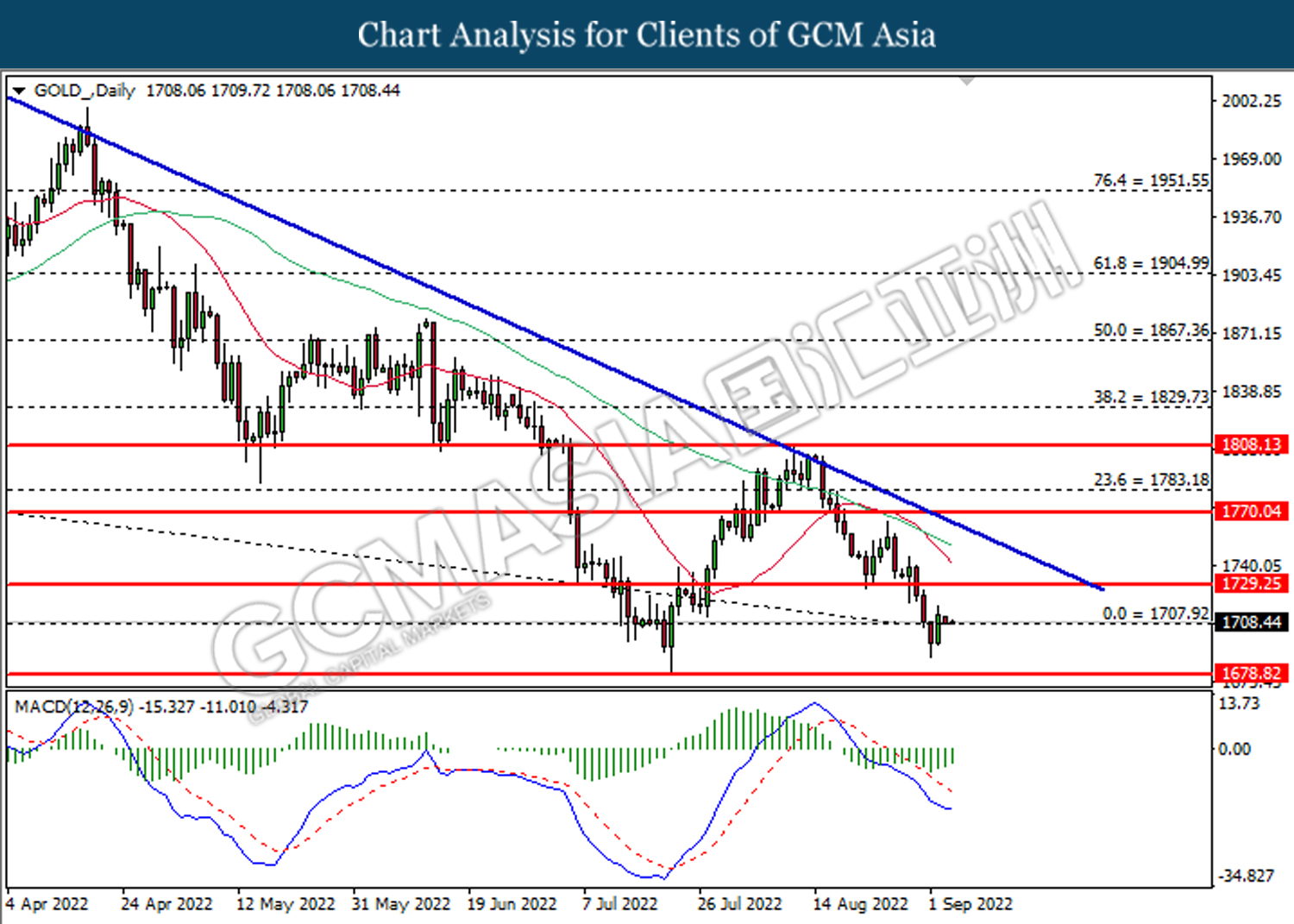

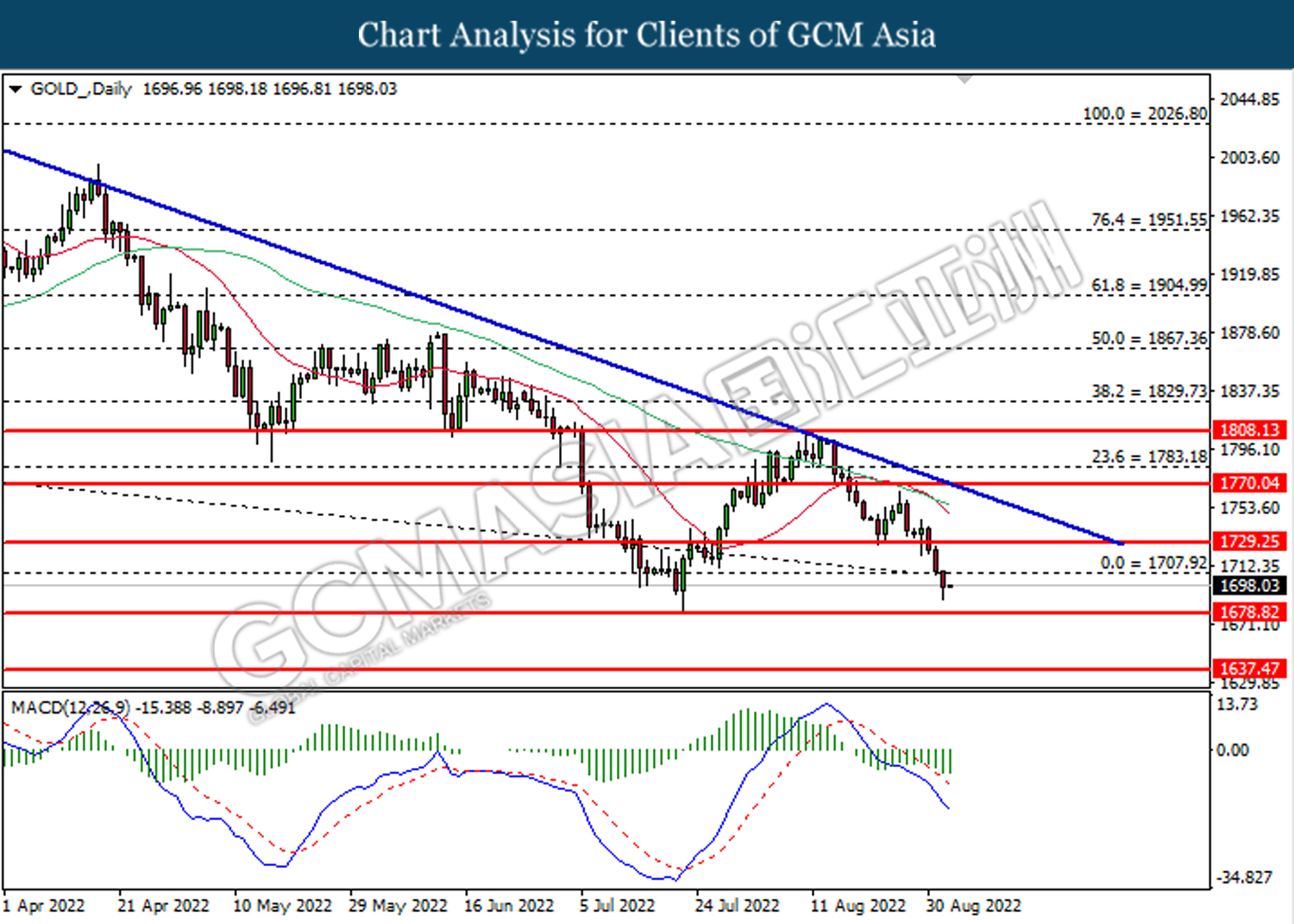

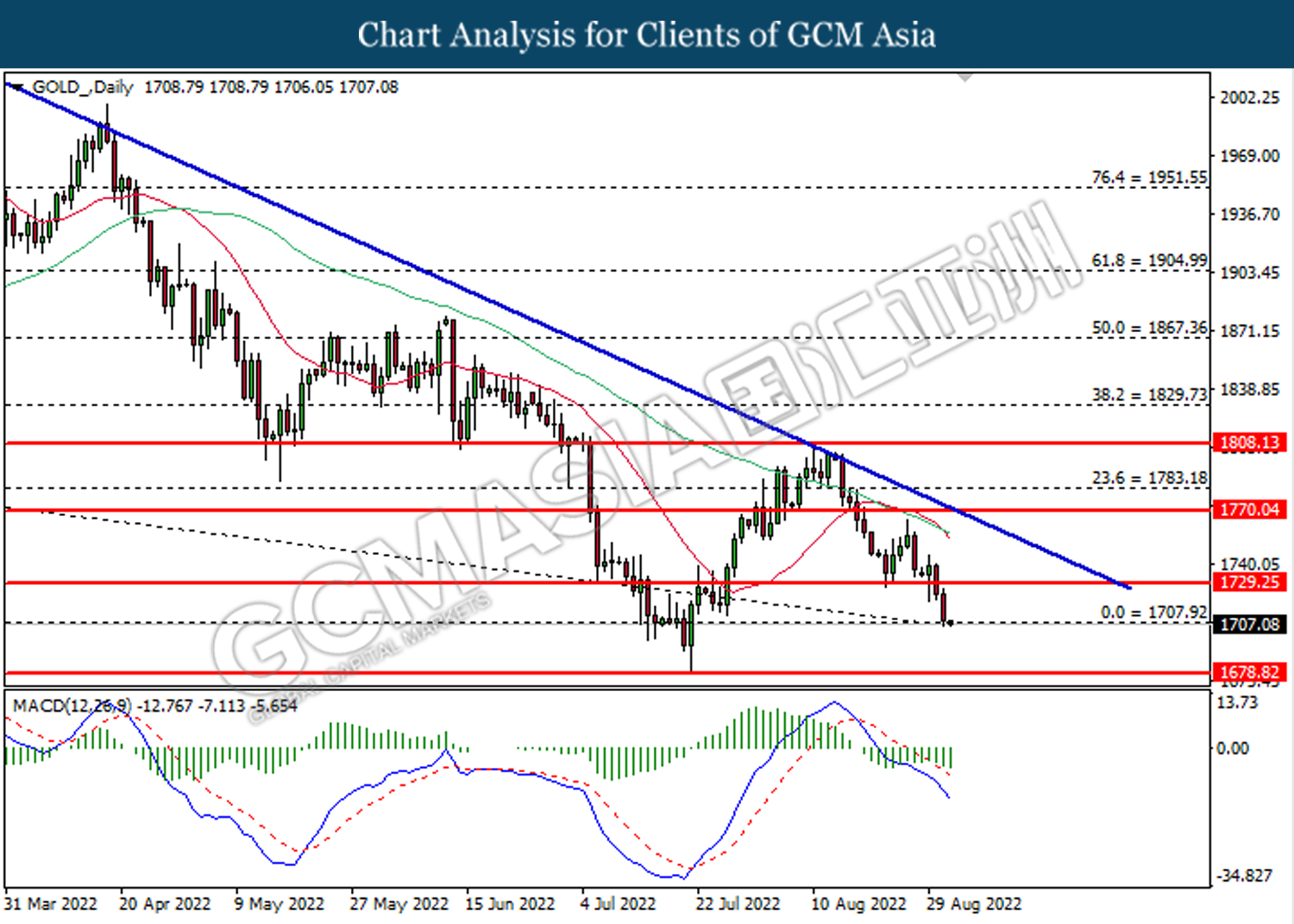

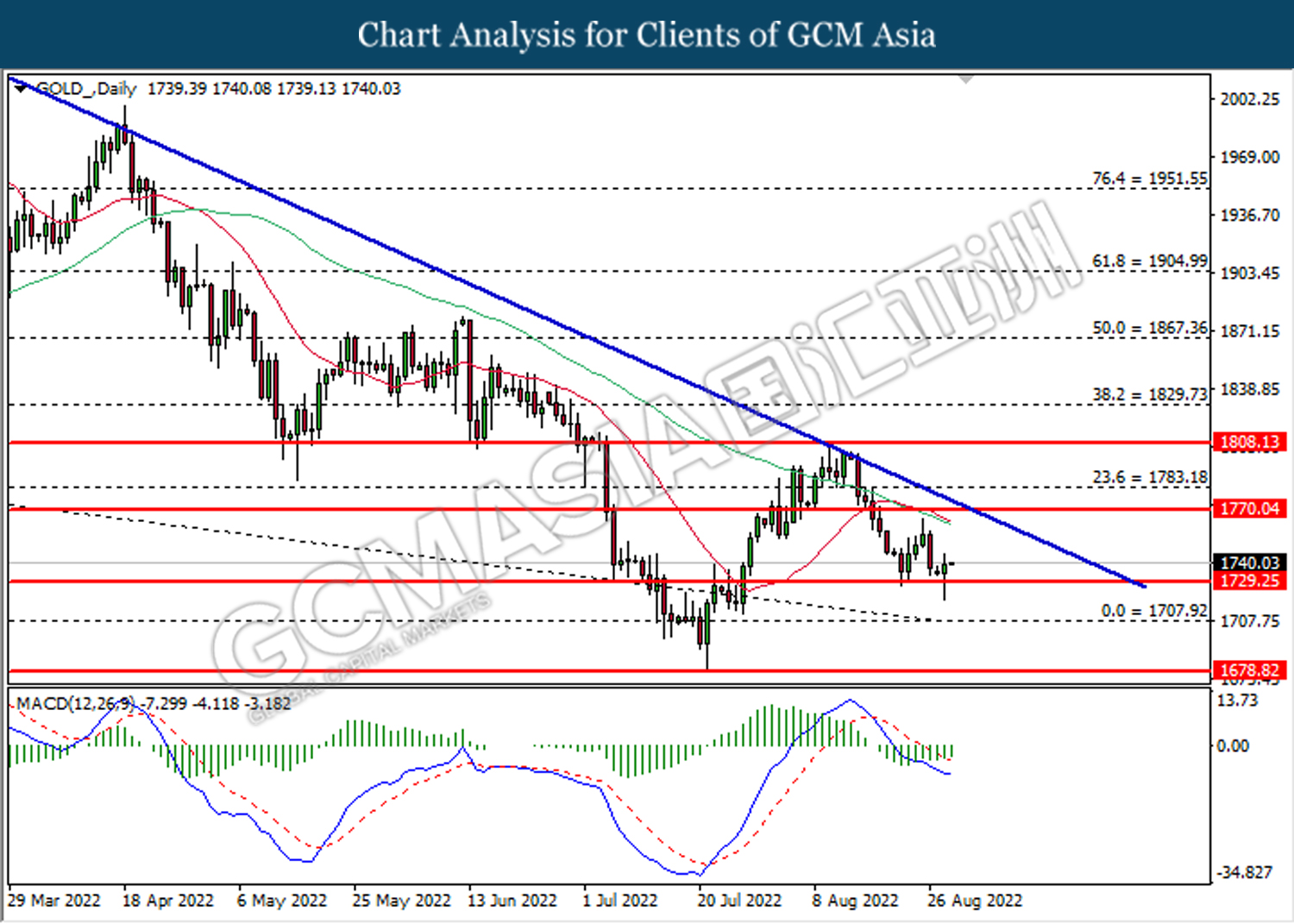

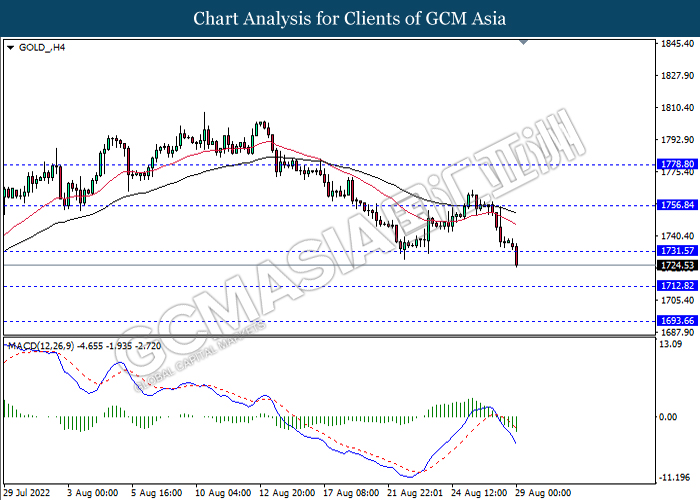

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

080922 Morning Session Analysis

8 September 2022 Morning Session Analysis

US Dollar retreated following 10-year YTM eased.

The Dollar Index which traded against a basket of six major currencies retreated from its higher level following the US bond yield start to ease after hitting the highest since 2011. The riskier asset such as US stock indexes climbed the most in roughly a month, with investors brushed aside the earlier hawkish tone made by Federal Reserve on Wednesday. High-growth companies in those technology sector tend to benefit when yields retreated as it means for a lower discount rate for the analyst when they are calculating the intrinsic value for the companies. In addition, the US Dollar extend its losses following Federal Reserve expressed some of their concerns toward the economic growth in United States in future. According to Federal Reserve’s Beige Book which released on Wednesday, Fed claimed that the outlook for future economic growth remains pessimistic as rising food and rent prices have forced consumers to switch spending into essentials product instead of luxury goods. Nonetheless, investors would currently continue to scrutinize the US Federal Reserve President Jerome Powell’s speech on Thursday as well as US Consumer price data for next week to receive further trading signal. As of writing, the Dollar Index depreciated by 0.62% to 109.50.

In the commodities market, the crude oil price slumped 0.03% to $81.90 per barrel as of writing. The oil market edged lower following the released of US Inventory data. According to American Petroleum Institute (API), the US API Weekly Crude Oil Stock came in at 3.645M, exceeding the market forecast at -0.733M. On the other hand, the gold price surged 0.03% to $1716.85 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:15 EUR ECB Interest Rate Decision (Sep)

20:45 EUR ECB Press Conference

21:10 USD Fed Chair Powell Speaks

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Sep) | 0.00% | 0.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.75% | – | – |

| 20:30 | USD – Initial Jobless Claims | 232K | 240K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 3.326M | – | – |

Technical Analysis

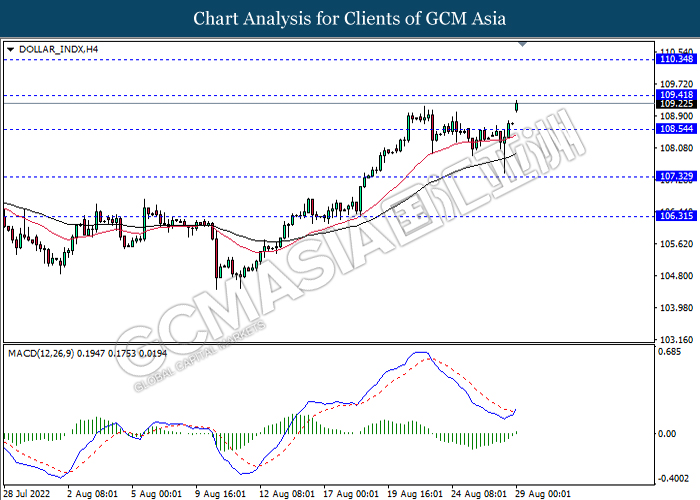

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

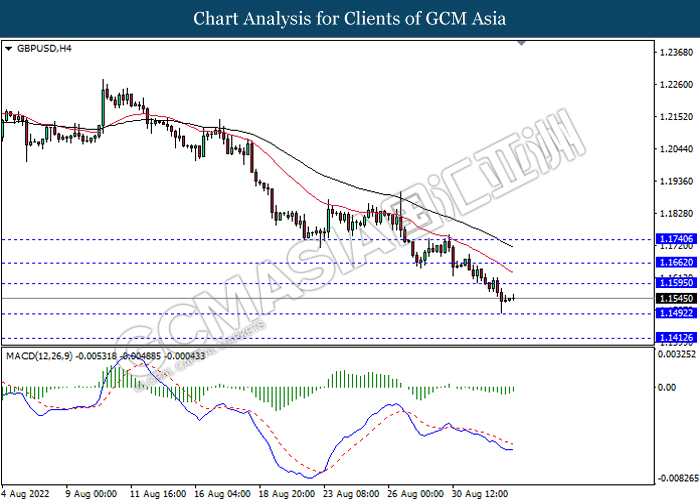

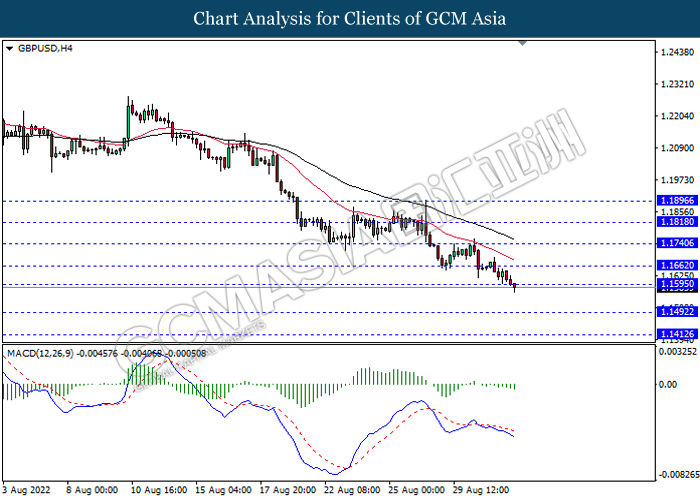

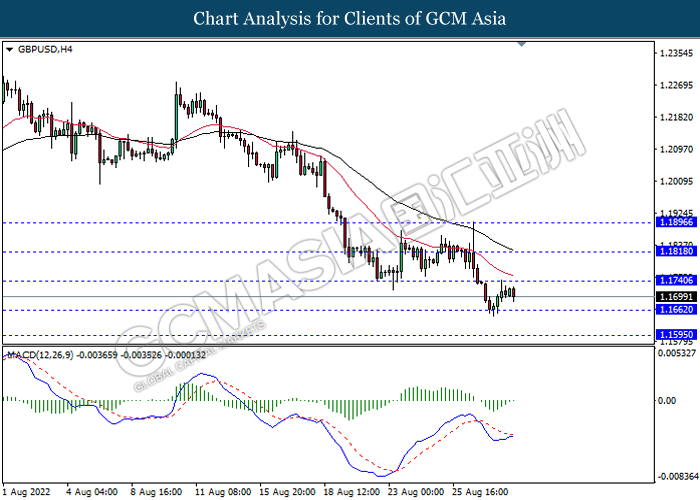

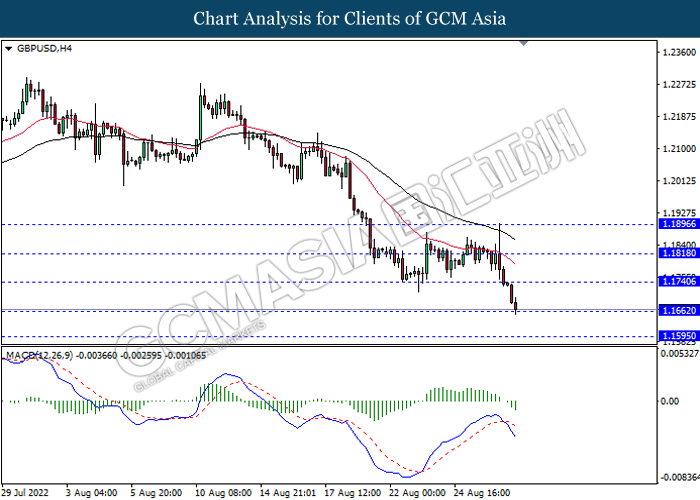

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

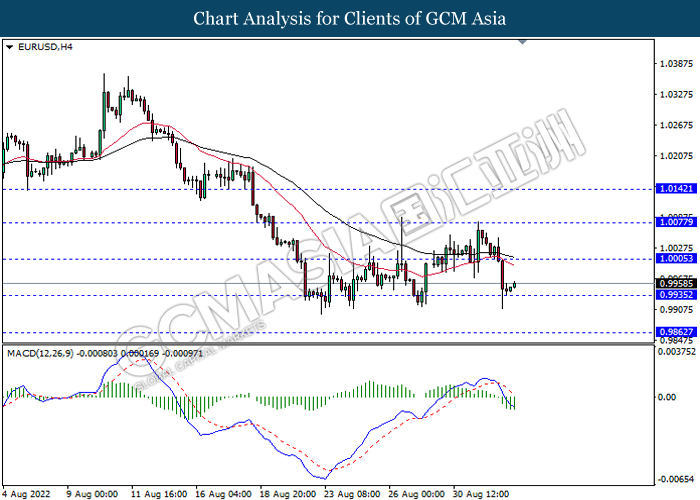

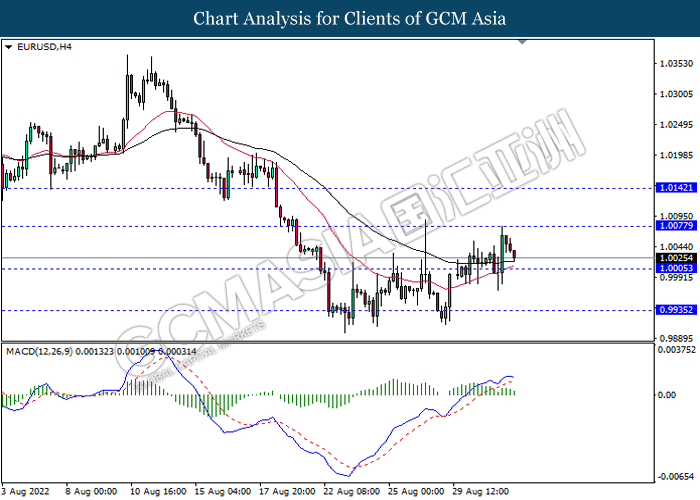

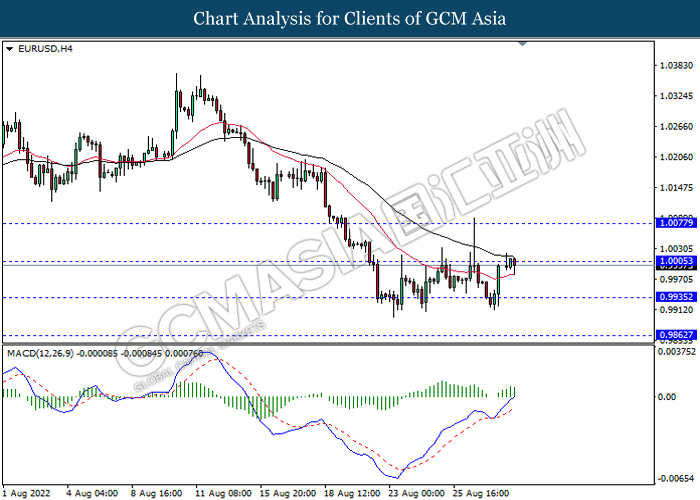

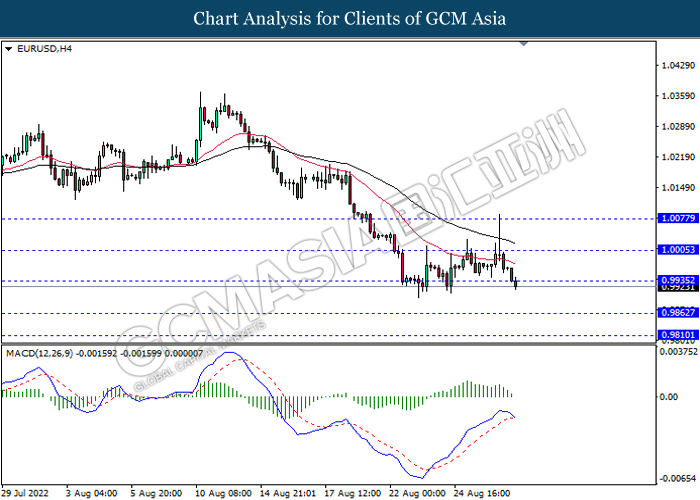

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0320, 1.0745

Support level: 0.9875, 0.9400

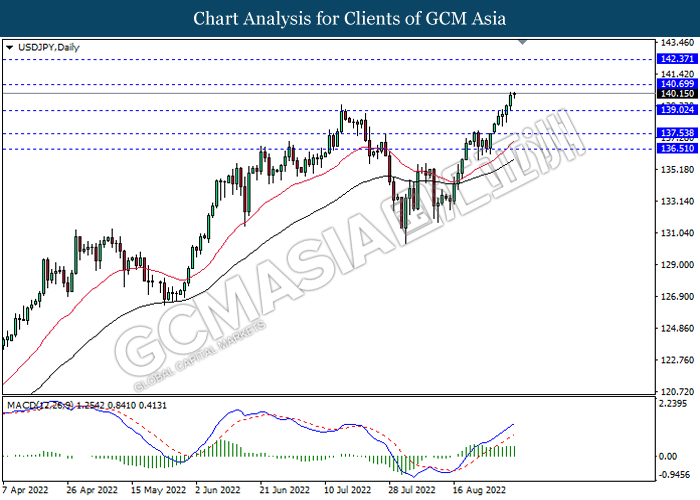

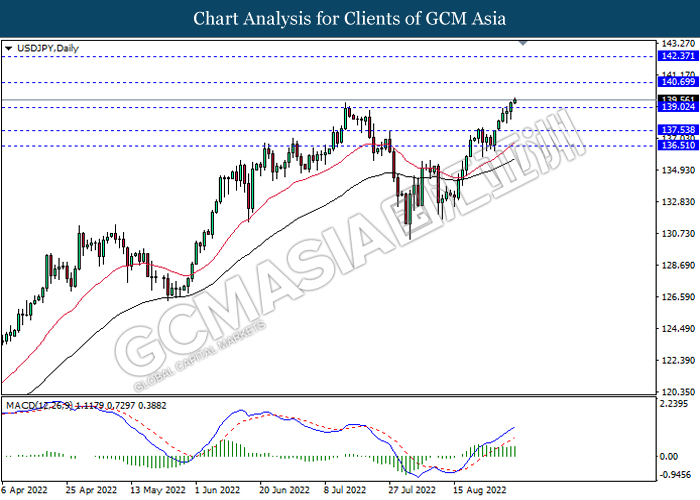

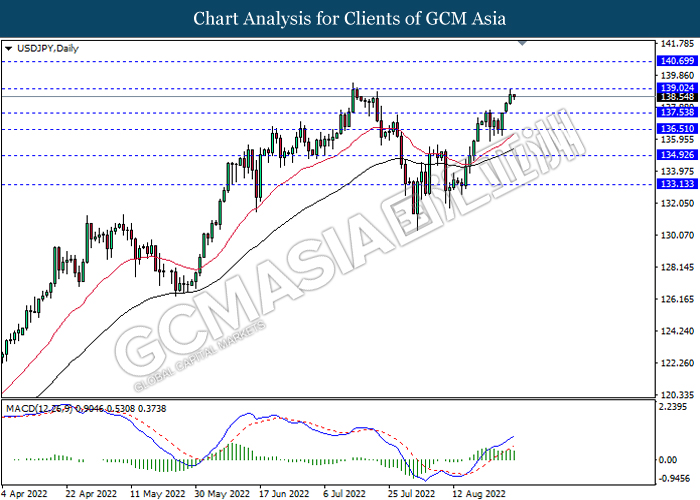

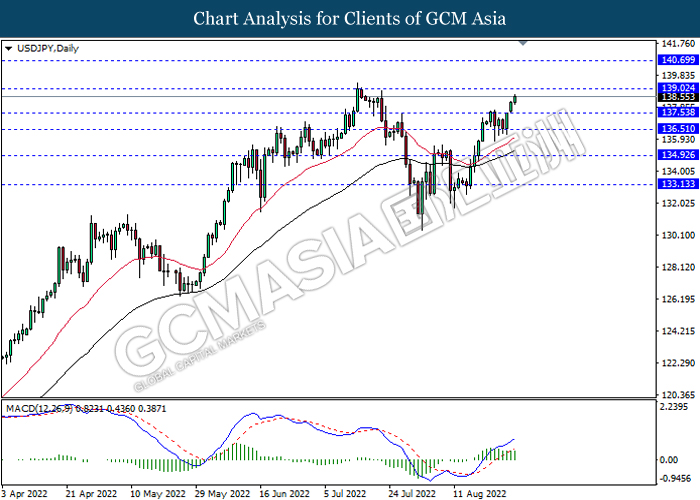

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 150.75.

Resistance level: 150.75, 160.00

Support level: 142.95, 138.15

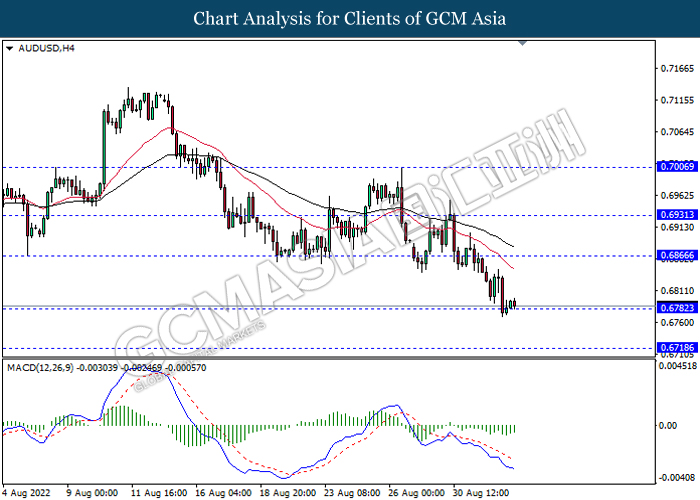

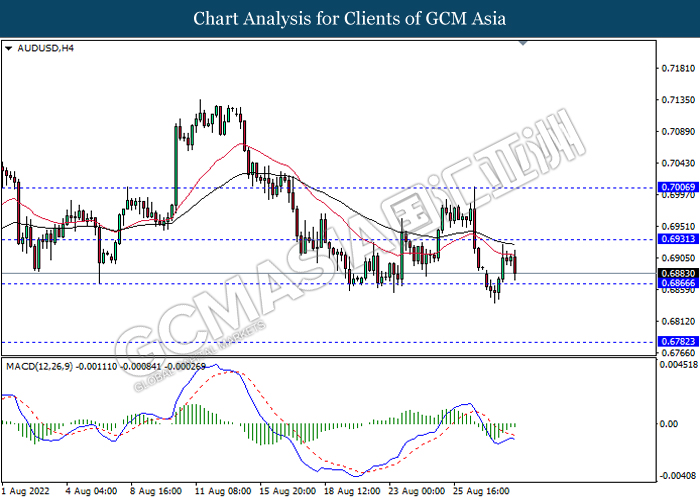

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

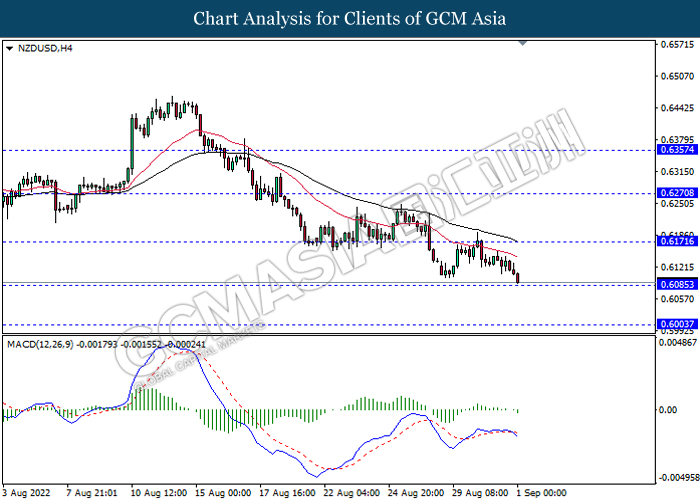

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6190, 0.6330

Support level: 0.6050, 0.5920

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3130, 1.3320

Support level: 1.2955, 1.2755

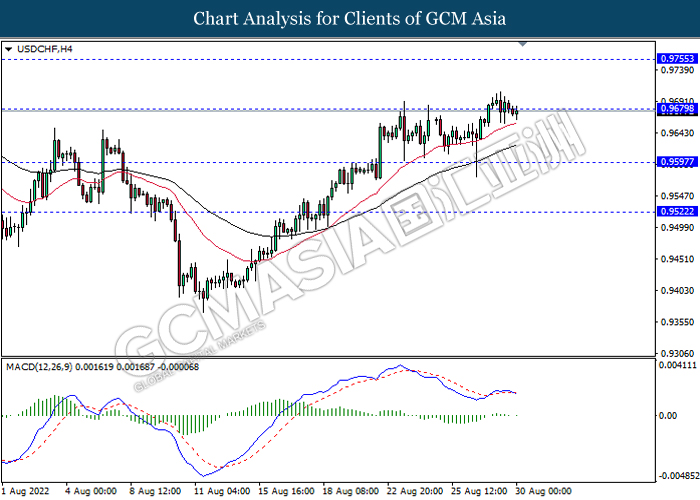

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9855, 0.9980

Support level: 0.9740, 0.9635

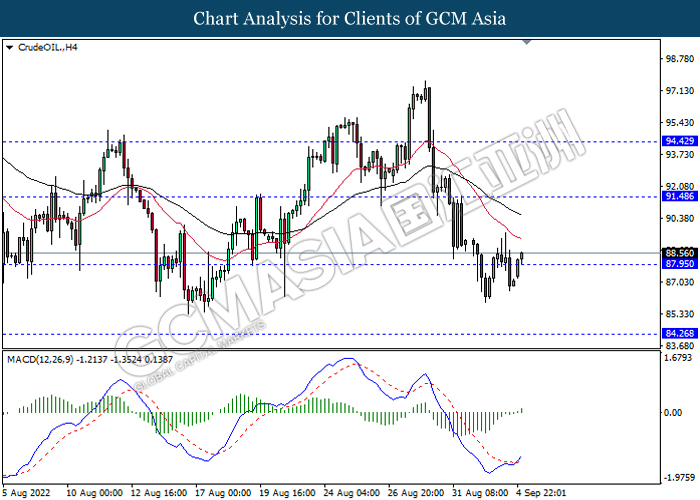

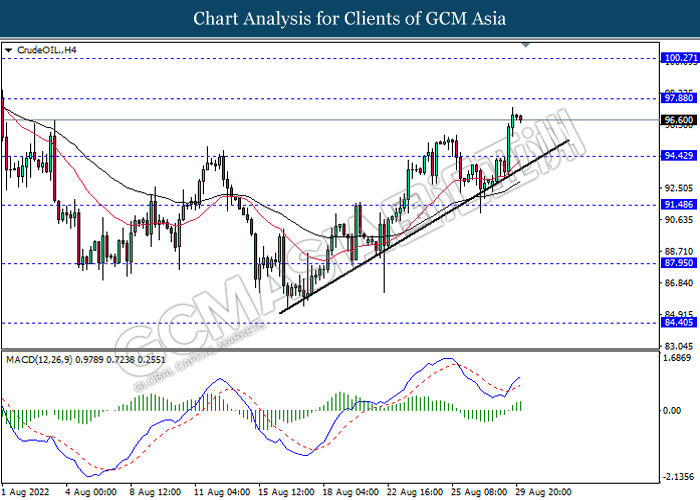

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 84.70, 93.15

Support level: 75.25, 66.25

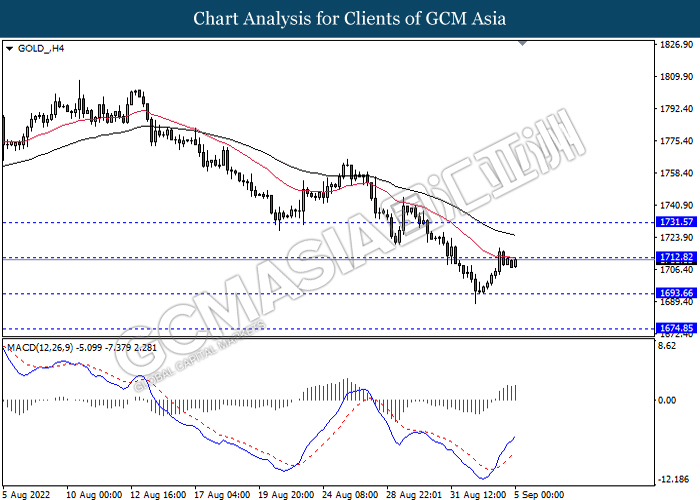

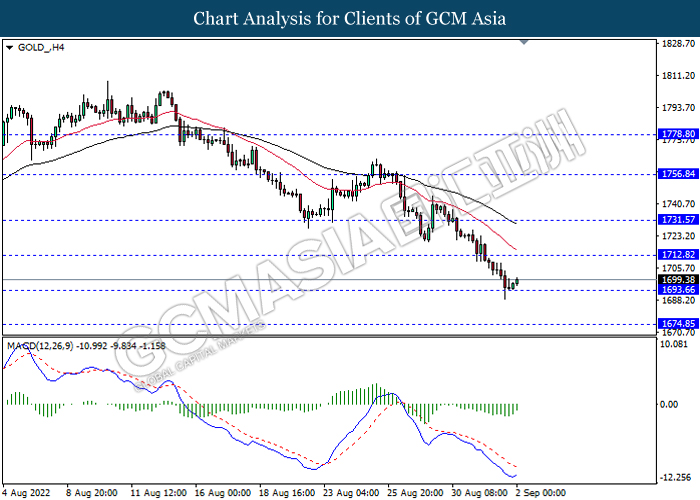

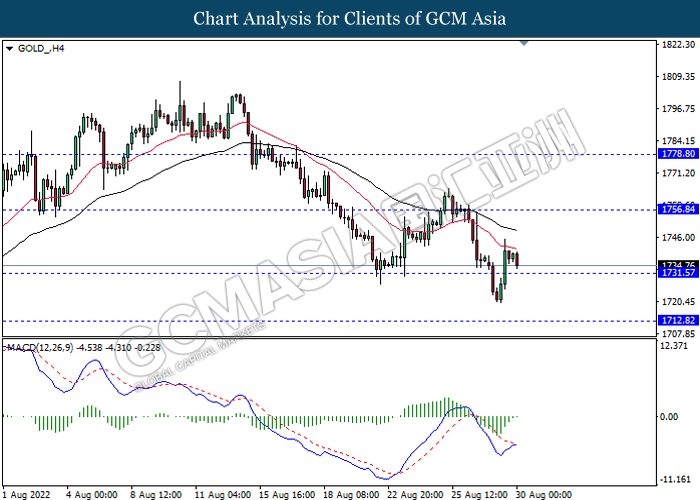

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1716.00, 1739.80

Support level: 1693.65, 1680.00

070922 Afternoon Session Analysis

7 September 2022 Afternoon Session Analysis

Aussie slumped as pessimistic economic outlook.

The Australia Dollar extends its losses yesterday over the backdrop of downbeat economic data from the Australia region. According to Australian Bureau of Statistics, Australian Gross Domestic Product (GDP) for last quarter came in at 0.9%, which missing the market forecast at 1.0%. The pessimistic reading had indicated that the economic momentum in the Australia region may now be slowing down amid rising price pressures as well as the downbeat economic outlook for the Australia’s largest trading partner (China) due to the implementation of the Chinese “zero-Covid” strategy. Nonetheless, the loses experienced by the Aussie was still limited by the rate hike decision from Reserve Bank of Australia. According to the Monetary Policy Statement, the RBA has raised its benchmark interest for a fifth month in a row into 2.35% to curb the spiking inflation risk. As of writing, AUD/USD depreciated by 0.51% to 0.6700.

In the commodities market, the crude oil price slumped by 1.88% to $85.35 per barrel as of writing. The crude oil price down significantly on Wednesday as Covid-19 restriction in top crude importer China as well as the rate hike expectation from global central bank had continue to spur concerns on global economic recession. On the other hand, the gold price retreated by 0.54% to $1692.50 per troy ounces as of writing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 GBP BoE Gov Bailey Speaks

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 2.50% | 3.25% | – |

| 22:00 | CAD – Ivey PMI (Aug) | 49.6 | 48.3 | – |

Technical Analysis

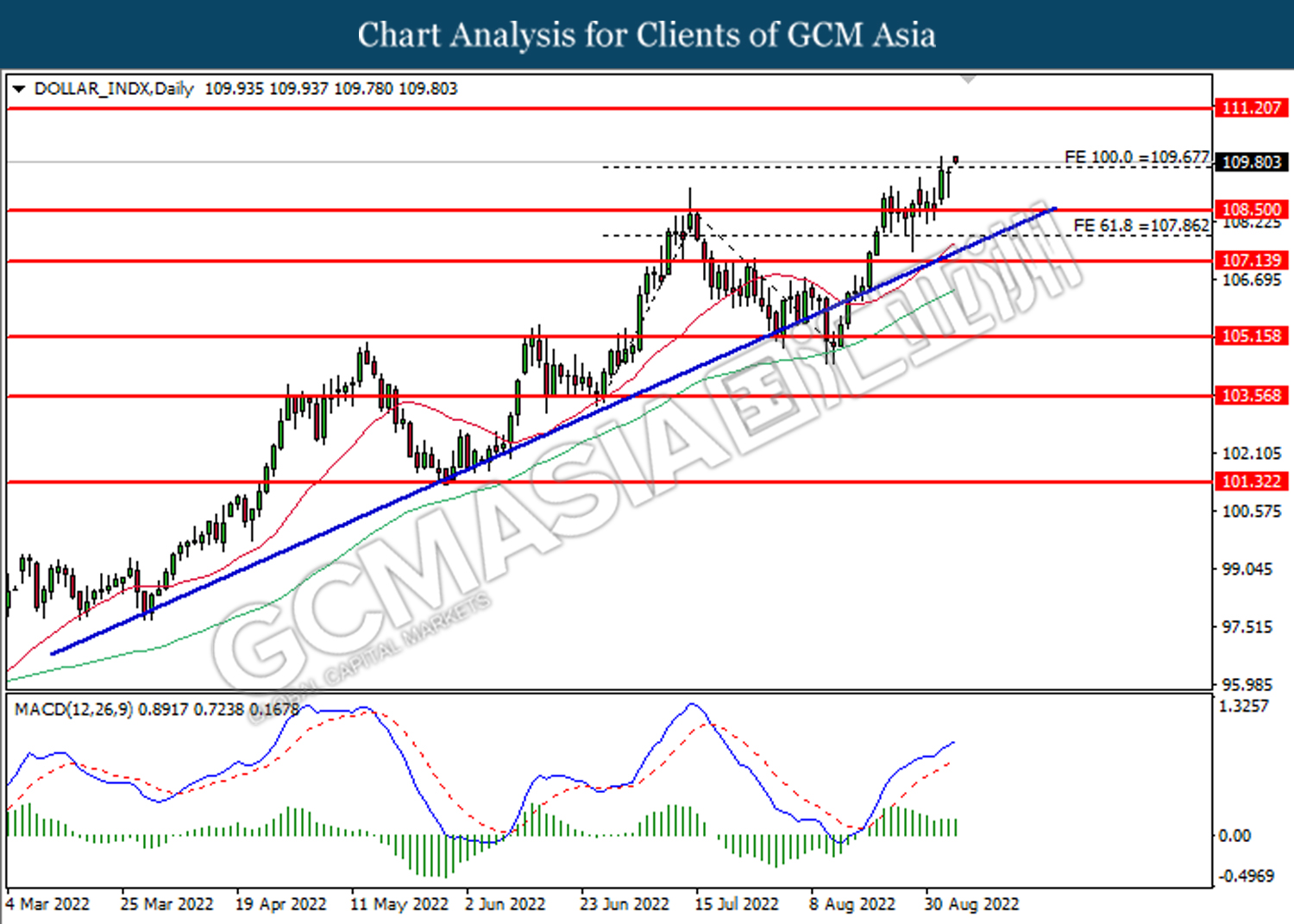

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 111.70, 115.90

Support level: 109.10, 104.80

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1590, 1.1690

Support level: 1.1445, 1.1350

EURUSD, H1: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9975, 1.0060

Support level: 0.9880, 0.9815

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 144.60, 150.55

Support level: 140.95, 134.90

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6570

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6070, 0.6225

Support level: 0.5935, 0.5840

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3205, 1.3320

Support level: 1.3105, 1.2955

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9865, 0.9990

Support level: 0.9720, 0.9560

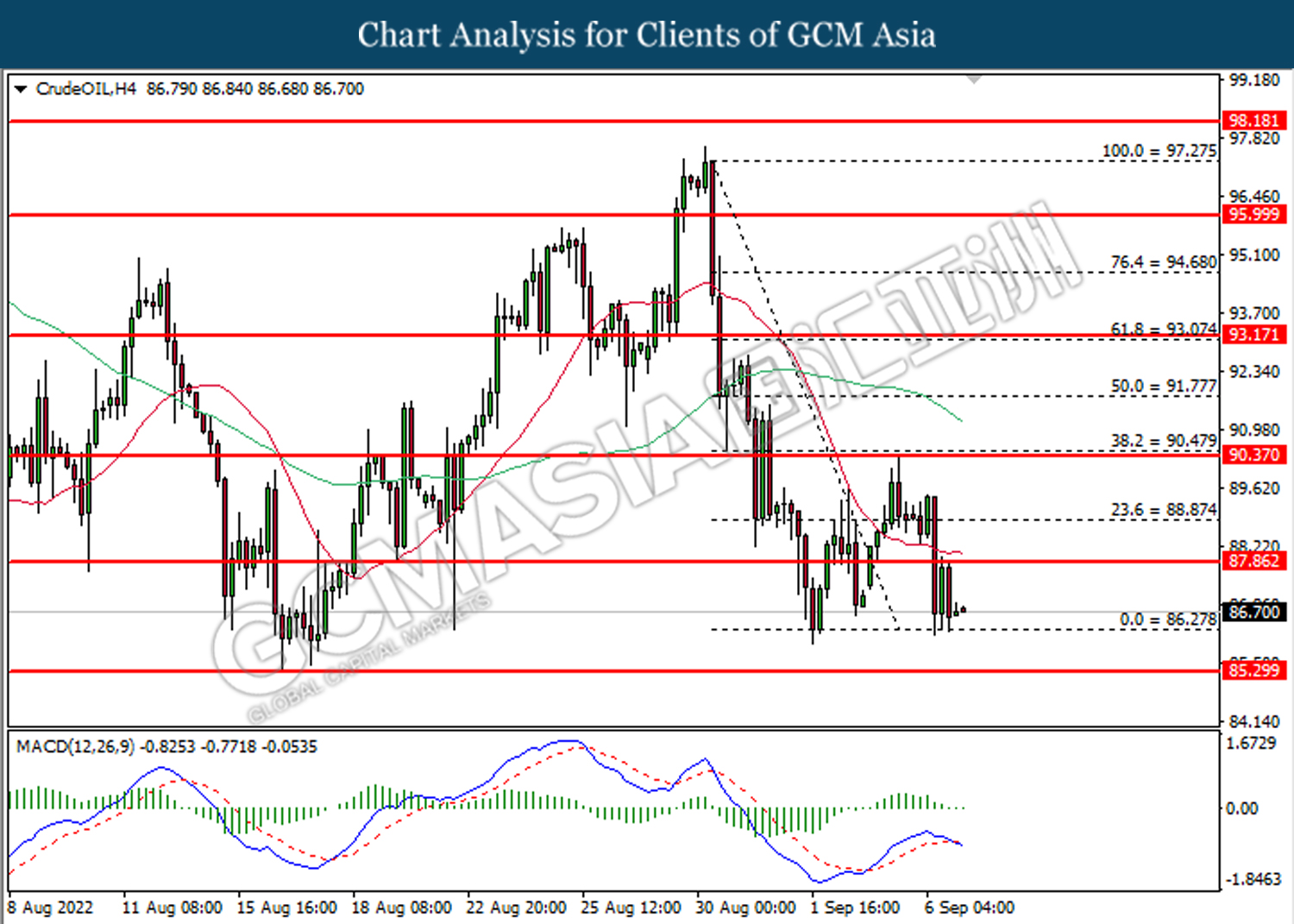

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 89.65, 94.10

Support level: 84.35, 79.45

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1716.00, 1739.80

Support level: 1695.10, 1680.00

070922 Morning Session Analysis

7 September 2022 Morning Session Analysis

Greenback jumped as momentum remained in services sector.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its gains yesterday as the services sector accelerated unexpectedly in August. According to the ISM, US Non-Manufacturing PMI rose from the prior month’s reading 56.7 to 56.9 for the month of August, while recording a higher figure compared to the consensus forecast at 55.1. The stronger-than-expected data was mainly attributed to the stronger order growth and employment in the US, which denied the market views that the economy was in a recession. Prior to now, the majority of the investors were worried that the economy had entered into a recession phase as the gross domestic product contracted in the first half of the year. On the other hand, the appeal of the greenback as a safe haven currency strengthened as the energy crisis in Europe loomed. Earlier this week, Russia revealed that the closure of Nord Stream 1 will be continued until the western sanction is removed. The sudden pause in natural gas flow from Russia to Europe exacerbated the energy imbalance, arousing investors’ curiosity about how Europe faced the winter months with insufficient stocks. As of writing, the dollar index is up 0.39% to 110.25.

In the commodities market, the crude oil price dropped by -2.71% to $86.85 a barrel as demand concerns outweighed the symbolic production cut by OPEC+. Besides, the gold prices edged down by -0.08% to $1700.65 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 GBP BoE Gov Bailey Speaks

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 2.50% | 3.25% | – |

| 22:00 | CAD – Ivey PMI (Aug) | 49.6 | 48.3 | – |

Technical Analysis

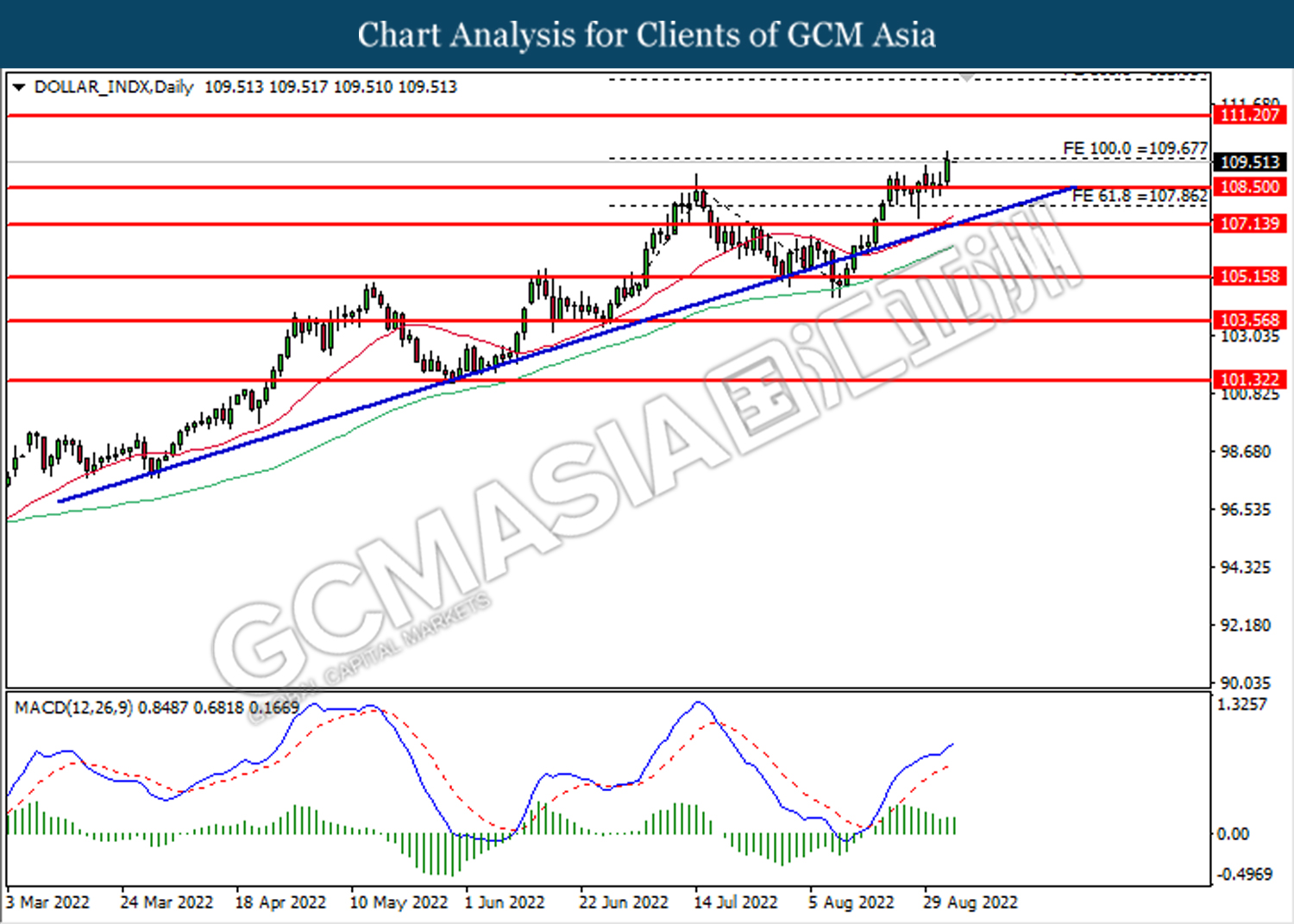

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 109.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the next resistance level at 111.20.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

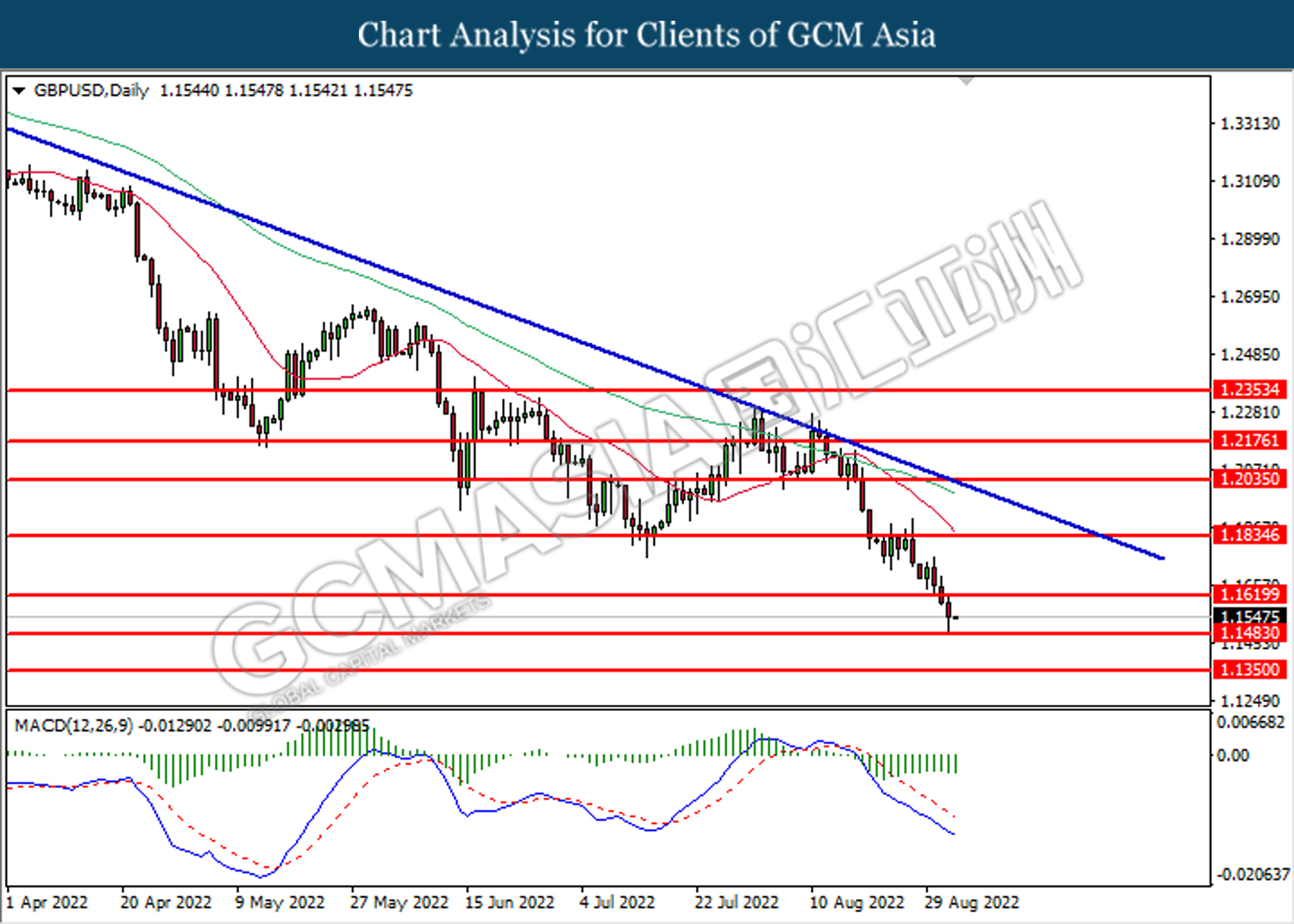

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1465.

Resistance level: 1.1620, 1.1775

Support level: 1.1465, 1.1350

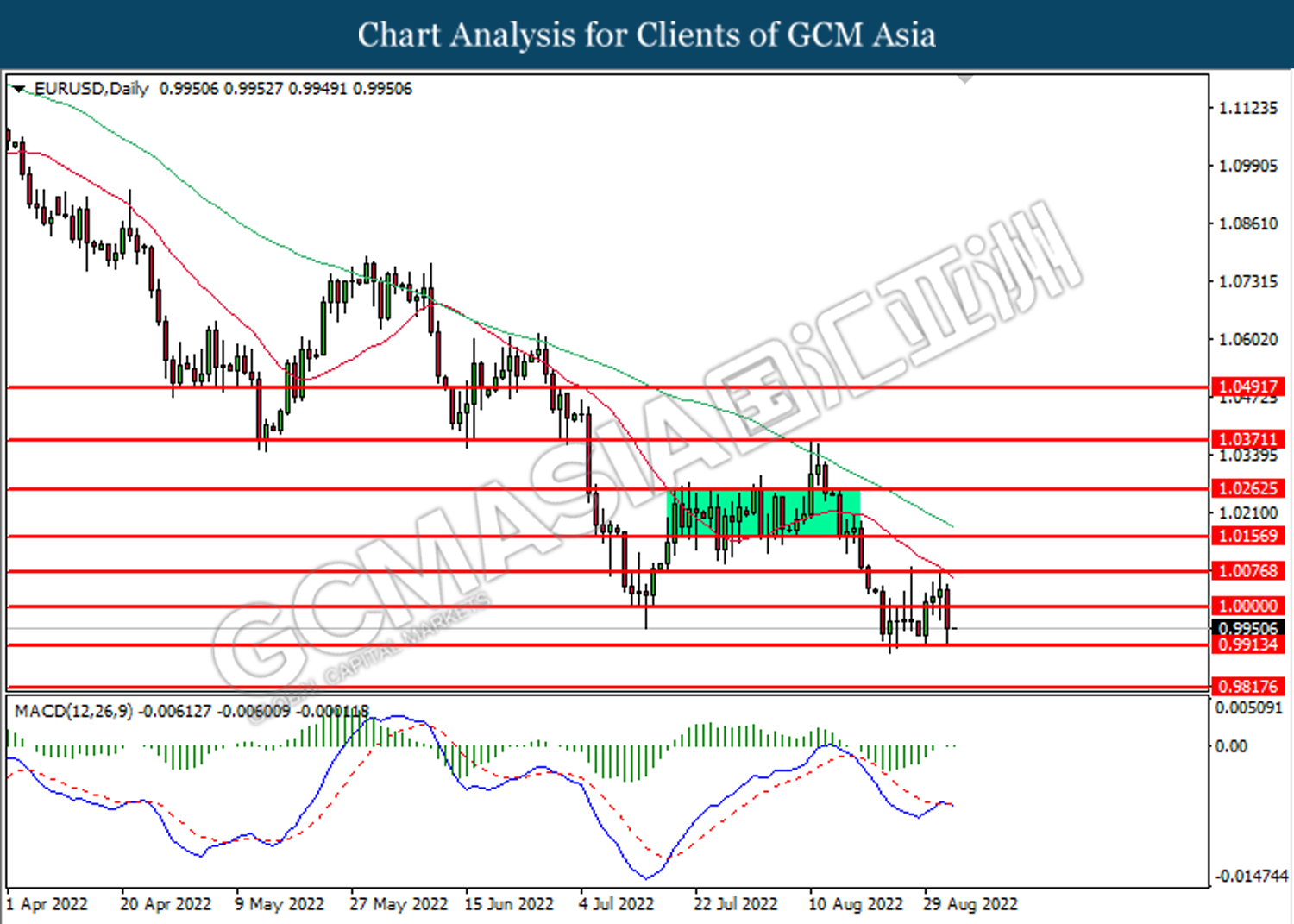

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9910. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 141.50. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 144.15.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3140. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9825. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 86.30. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 87.85, 88.85

Support level: 86.30, 85.30

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1707.90. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

060922 Afternoon Session Analysis

6 Sep 2022 Afternoon Session Analysis

Euro remain pressured as energy crisis risk heightened.

The Euro, which is the single currency of the Eurozone, continued to hover near the 20-year low following natural gas flow halted to Europe. Yesterday, Russia said it was shutting the natural gas pipeline – Nord Steam 1, which supplies gas to Europe, for maintenance. The Nord Stream 1 pipeline, which has been operational since 2011, is the single biggest gas pipeline carrying gas between Russian and Western Europe. According to the latest statement from the Moscow, Russian gas supplies to Europe will not resume until sanctions against Moscow are lifted. The Kremlin said on Monday the Western sanctions were the sole reason behind Russia’s decision to shut the Nord Stream 1 pipeline. With the gas pipeline halted, the market fears over the energy crisis in Eurozone heightened, whereby the Europe would face further imbalances between the energy supply and demand before the winter season. As the investors reckon the hit to its economy will be huge, hence, sell-off activities have been taken by the investor, urging the value of the Euro depreciated further. As of writing, the pair of EUR/USD up by 0.29% to 0.9955.

In the commodities market, crude oil prices edged down by -0.54% to $88.90 per barrel as the market participants digested the news of small oil production cut by OPEC+. Besides, gold prices appreciated 0.39% to $1717.35 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Aug) | 48.9 | 48.0 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Aug) | 56.7 | 55.1 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 110.00. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward the support level at 108.50.

Resistance level: 110.00, 112.20

Support level: 108.50, 107.00

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 0.9900. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 139.00. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 141.50, 143.50

Support level: 139.00, 135.55

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6775. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6865.

Resistance level: 0.6865, 0.6930

Support level: 0.6775, 0.6730

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6045. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6220.

Resistance level: 0.6220, 0.6350

Support level: 0.6045, 0.5950

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3145. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3030.

Resistance level: 1.3145, 1.3220

Support level: 1.3030, 1.2940

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9840. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9720.

Resistance level: 0.9840, 1.0030

Support level: 0.9720, 0.9625

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 86.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 93.05.

Resistance level: 93.05, 98.15

Support level: 86.70, 79.45

GOLD_, Daily: Gold price was traded higher following prior retracement from the support level at 165.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1755.00.

Resistance level: 1755.00, 1803.85

Support level: 1695.25, 1638.40

060922 Morning Session Analysis

6 September 2022 Morning Session Analysis

Pound rose upon the optimistic speech from new UK Prime Minister.

The GBP/USD, which traded by majority of investors edged up on yesterday with the background of new UK Prime Minister announcement. According to Bloomberg, the new UK Prime Minister has been announced. Liz Truss, who was the foreign secretary of the nation, has won the vote to succeed Boris Johnson as UK prime minister. She would take responsible to tackle brutal economic headwinds that threaten to plunge millions of Britons into poverty this winter. The new UK Prime Minister has claimed after winning the vote that the tax cut would be implemented in order to rescue citizens from the soaring energy and living prices, which brought positive prospects toward economic progression of UK. Though, the current UK economy still facing recession as the downbeat economic data has been unleashed, which limited the gains of Pound Sterling. A series of data such as UK Services Purchasing Managers Index (PMI) and UK Composite Purchasing Managers’ Index (PMI) has given a figures that lower-than-expected. As of writing, GBP/USD appreciated by 0.60% to 1.1585.

In the commodities market, the crude oil price raised by 2.31% to $88.88 per barrel as of writing following the OPEC+ decided to diminish the oil output. On the other sides, the gold price rose by 0.57% to $1732.20 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Interest Rate Decision (Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Aug) | 48.9 | 48.0 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Aug) | 56.7 | 55.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1595, 1.1660

Support level: 1.1490, 1.1410

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3135, 1.3240

Support level: 1.3050, 1.2935

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses of successfully breakout the support level.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.25

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1731.55, 1753.00

Support level: 1712.80, 1693.65

050922 Afternoon Session Analysis

5 September 2022 Afternoon Session Analysis

Euro dipped as energy crisis risk heightened.

The EUR/USD, which traded by global investors dropped significantly on last Friday amid the rising fears upon energy crisis faced by European. According to Bloomberg, Russia energy company Gazprom had claimed on Friday that they would not resume the gas supply via Nord-Stream 1 on Saturday as planned due to the oil leak at its Portovaya compressor station. The company did not mention the date of reopening the gas pipeline after maintenance as well as it said that the Nord Stream pipeline would completely stopped until the equipment operation has been solved. The lack supply of commodities would deteriorated the energy issues in Europe region before entering into winter season, which dialed down the market optimism toward European economic momentum. Besides that, European are still facing the issues of spiking power and gas price, spurring further bearish momentum on the Euro. As of writing, EUR/USD eased by 0.37% to 0.9914.

In the commodities market, the crude oil price rose by 1.81% to $88.44 per barrel as of writing as investors awaited details on potential OPEC production cuts from a meeting later in the day. On the other sides, the gold price appreciated by 0.04% to $1712.18 per troy ounce as of writing over the US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Labor Day

All Day CAD Labor Day

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Aug) | 50.9 | 50.9 | – |

| 16:30 | GBP – Services PMI (Aug) | 52.5 | 52.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 110.35, 111.30

Support level: 109.40, 108.55

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1490, 1.1595

Support level: 1.1410, 1.1330

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9935, 1.0005

Support level: 0.9860, 0.9810

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3240, 1.3320

Support level: 1.3135, 1.3050

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.25

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1712.80, 1731.55

Support level: 1693.65, 1674.85

050922 Morning Session Analysis

5 September 2022 Morning Session Analysis

Greenback buoyed following mixed employment data.

The dollar index, which gauges its value against a basket of six major currencies, dropped significantly right after the Nonfarm Payrolls and Unemployment data were released. According to the Bureau of Labor Statistics, US Nonfarm Payrolls rose 315K in August, above the consensus expectation for 310K, but far below the previous month reading’s 526K. The upbeat Nonfarm Payrolls data indicated that the companies hiring activity remained strong throughout the month of August. On the other hand, the US Unemployment data came in at 3.7%, higher than the consensus forecast at 3.5%, largely due to a jump in the labor force participation rate to 62.4%, which is at the highest level of the year. As such, the 0.2% rise in the unemployment rate does not reflect that the labor market is at the brink of unfavorable condition. On top of that, with an overall positive labor data been released, it provided rooms for Federal Reserve to increase the rate further, tackling the sky-high inflation, which is currently encountered by the American. As of writing, the dollar index rose 0.32% to 109.90.

In the commodities market, the crude oil price was up by 0.50% to $87.90 a barrel after the Nord Stream 1 fully stopped the gas flow due to oil leakage. Besides, the gold prices edged down by -0.20% to $1709.40 per troy ounce following the release of the upbeat NFP data in the US.

Today’s Holiday Market Close

Time Market Event

All Day USD Labor Day

All Day CAD Labor Day

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Aug) | 50.9 | 50.9 | – |

| 16:30 | GBP – Services PMI (Aug) | 52.5 | 52.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 109.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the next resistance level at 111.20.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1485. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1485, 1.1620

Support level: 1.1350, 1.1200

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9910. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 139.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.50.

Resistance level: 141.50, 144.15

Support level: 139.25, 136.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3140. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9825. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 87.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 88.85.

Resistance level: 88.85, 90.35

Support level: 87.85, 86.30

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

020922 Afternoon Session Analysis

2 September 2022 Afternoon Session Analysis

Aussie slipped on downbeat economic data.

The AUD/USD, which well known by global investors, dropped significantly on yesterday amid the bearish economic data, which spurred bearish momentum on the Australia Dollar. According to Markit, the China Caixin Manufacturing Purchasing Managers Index (PMI) for August notched down from the previous reading of 50.4 to 49.5, lower than the consensus expectation of 50.2. The figures that lower than 50 means a contraction in China manufacturing sector, which brought negative prospects toward economic progression in China. Besides, the China economy was deteriorated upon the background of lockdown which driven by Covid-19 pandemic. Thus, as China was the trading partner for Australia, the pessimistic economic outlook has suppressed the value of Aussie. Nonetheless, the losses experienced by Aussie was limited over the rate hikes expectation from Reserve Bank of Australia (RBA). According to Reuters, the Australia’s central bank would raise its interest rate by 0.50% on 6 September to stabilize the spiking inflationary pressure. As of writing, the AUD/USD appreciated by 0.09% to 0.6789.

In the commodities market, the crude oil price rose by 1.71% to $88.09 per barrel as of writing following the expectation of output cuts from OPEC+. On the other hand, the gold price edged up by 0.03% to $1699.15 per troy ounce as of writing after a sharp decline throughout yesterday trading session amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Aug) | 528K | 300K | – |

| 20:30 | USD – Unemployment Rate (Aug) | 3.5% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 110.35, 111.30

Support level: 109.40, 108.55

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1595, 1.1660

Support level: 1.1490, 1.1410

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6085, 0.6170

Support level: 0.6005, 0.5925

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3240, 1.3320

Support level: 1.3135, 1.3050

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.25

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1712.80, 1731.55

Support level: 1693.65, 1674.85

020922 Morning Session Analysis

2 September 2022 Morning Session Analysis

Upbeat data provides room for aggressive rate hike.

The dollar index, which gauges its value against a basket of six major currencies, jumped significantly yesterday as a series of upbeat data allowed the Federal Reserve for further rate hikes in the coming meeting. According to the Institute for Supply Management (ISM), US Manufacturing sector grew steadily as new orders increased while the hiring activities surged in August. The data came in at 52.8, similar to the prior month reading but slightly higher than the consensus forecast at 52.0. A reading of above 50 indicates an expansion in the US manufacturing sector. On the other sides, the US weekly Initial Jobless Claims has shown a consecutive drop for third straight week amid continued labor market tightness. According to the Bureau of Labor Statistics, the number of Americans who filed for unemployment benefits dropped from 237K to 232K, while recording a lower figure compared to the consensus forecast at 248K. Despite, the eyes of the investor are all now on the Nonfarm Payrolls data, which will be released tonight 20:30PM (GMT+8) sharp, as the data would provide a clearer picture about the ongoing labor market condition in the US. As of writing, the dollar index up by 0.86% to 109.65.

In the commodities market, the crude oil price was down by -0.03% to $86.40 a barrel as the new round of lockdown across the major cities in China stoked the demand fears. Besides, the gold prices edged down by -0.12% to $1695.65 per troy ounce following the release of the upbeat data in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Aug) | 528K | 300K | – |

| 20:30 | USD – Unemployment Rate (Aug) | 3.5% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1620, 1.1835

Support level: 1.1485, 1.1350

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9915.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 139.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.50.

Resistance level: 141.50, 144.15

Support level: 139.25, 136.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3135. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3135, 1.3220

Support level: 1.3050, 1.2985

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9750. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9825.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its rebound toward the resistance level at 87.85.

Resistance level: 87.85, 90.35

Support level: 85.30, 82.75

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1707.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1678.80.

Resistance level: 1707.90, 1729.25

Support level: 1678.80, 1637.45

010922 Afternoon Session Analysis

1 September 2022 Afternoon Session Analysis

Euro rose as inflation in European heightened.

The EUR/USD, which traded by majority of investors surged significantly on yesterday over the higher-than-expected CPI data. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY for August notched up from the previous reading of 8.9% to 9.1%, exceeding the market expectation of 9.0%. The CPI figure which higher than prior had shown that the inflationary issue in Eurozone still having the sign to rise, which adding the odds of rate hikes from ECB in order to tamp down the soaring prices. Earlier of the week, the ECB members have emphasized that the central bank should raise its interest rate, even though it would likely to disrupt economic growth. Besides, they reiterated that higher rate increase would be considered if the inflation risk keep hovering in the Eurozone. As of now, market participant would eye on ECB interest rate decision which scheduled on 8 September. Nonetheless, the gains of EUR/USD was limited over the hawkish speech from Federal Reserve member. As of writing, EUR/USD depreciated by 0.34% to 1.0023.

In the commodities market, the crude oil price dropped by 0.23% to $89.34 per barrel as of writing amid the return of the Iran nuclear deal could be imminent and it might be reached in upcoming weeks. On the other side, the gold price eased by 0.62% to $1705.02 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Aug) | 49.3 | 49.8 | – |

| 16:30 | GBP – Manufacturing PMI (Aug) | 46.0 | 46.0 | – |

| 20:30 | USD – Initial Jobless Claims | 243K | 248K | – |

| 22:00 | USD – ISM Manufacturing PMI (Aug) | 52.8 | 52.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1595, 1.1660

Support level: 1.1490, 1.1410

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0075, 1.0140

Support level: 1.0005, 0.9935

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3240, 1.3320

Support level: 1.3135, 1.3050

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.40

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1712.80, 1731.55

Support level: 1693.65, 1674.85

010922 Morning Session Analysis

1 September 2022 Morning Session Analysis

Dollar edged down amid downbeat employment data.

The dollar index, which gauges its value against a basket of six major currencies, failed to extend its upward momentum yesterday following the release of a weaker-than-expected data. According to the ADP, US Nonfarm Employment Change came in at 132K, far lower than the consensus forecast at 300K, while dropping significantly compared to the prior month reading’s 268K. It showed that the companies in the US have slowed down their hiring pace in August, highly due to the heightening fears of an economic recession. Prior to now, the ADP report was suspended for the past two months as the company revamped the methodology for the data after showing a great deviation between their prediction and the actual reading over the private payrolls’ figures in the Labor Department’s Bureau of Labor Statistics employment report. Nonetheless, with such a disappointing data, investors started to sell their holdings in the US dollar market and flee away to other market, such as Euro. Going forward, the attention of the investors were still the Nonfarm Payroll data on Friday, as the investor would rely on the data to scrutinize the further direction of the dollar index. As of writing, the dollar index dropped -0.08% to 108.70.

In the commodities market, the crude oil price was down by -0.02% to $89.10 a barrel as increased restriction to curb Covid-19 in China dampened the outlook of this black commodity. Besides, the gold prices edged down by -0.13% to $1708.90 per troy ounce amid the rebound in dollar index market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Aug) | 49.3 | 49.8 | – |

| 16:30 | GBP – Manufacturing PMI (Aug) | 46.0 | 46.0 | – |

| 20:30 | USD – Initial Jobless Claims | 243K | 248K | – |

| 22:00 | USD – ISM Manufacturing PMI (Aug) | 52.8 | 52.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 108.50. However, MACD which illustrated diminishing bullish momentum suggests the index to undergo technical correction in short term.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1620, 1.1835

Support level: 1.1485, 1.1350

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 139.35. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 139.35, 140.50

Support level: 138.00, 136.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3135. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3135, 1.3220

Support level: 1.3050, 1.2985

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9750. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9825.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 90.35. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 87.85.

Resistance level: 90.35, 93.15

Support level: 87.85, 85.30

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1707.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80

300822 Afternoon Session Analysis

30 August 2022 Afternoon Session Analysis

Euro jumped as ECB tend to bring down skyrocketed inflation.

The EUR/USD, which traded by majority of investors, surged on yesterday trading session amid the hawkish statement from European Central Bank (ECB). According to Bloomberg, the ECB has prepared to rate hike at least half-percentage in upcoming meeting. Besides, a larger move would be considered if the inflationary pressure keep rising. The aggressive tightening monetary policy would likely to increase the risk-free return of investors, which prompting investors to shift their capitals toward Euro market. Though, the gains experienced by Euro was limited amid the raising fears of energy shortage threat in European. Currently, the US would cooperate with European to alleviate that potential threat as well as European Union (EU) would hold an emergency meeting with energy ministers on 9th September in order to deal with spiking commodities prices. On the data front, investors would eye on Eurozone CPI data which scheduled tomorrow. As of writing, EUR/USD eased by 0.03% to 0.9992.

In the commodities market, the crude oil price depreciated by 0.38% to $96.64 per barrel as of writing as the global inflation diminished market demand on oil. On the other side, the gold price dropped by 0.11% to $1735.59 per troy ounce as of writing amid the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Aug) | 95.7 | 97.9 | – |

| 22:00 | USD – JOLTs Job Openings (Jul) | 10.698M | 10.475M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1740, 1.1820

Support level: 1.1660, 1.1595

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.00, 140.70

Support level: 137.55, 136.50

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6780

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9680, 0.9755

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 97.90, 100.25

Support level: 94.40, 91.50

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80

300822 Morning Session Analysis

30 August 2022 Morning Session Analysis

US dollar lost its ground after hitting the new high in 20 years.

The dollar index, which gauges its value against a basket of six major currencies, retreated after hitting the highest level in 20 years amid the profit taking activities in the dollar market. Prior to that, the greenback received huge buying momentum on Friday, when the Federal Reserve Chairman Jerome Powell told the Jackson Hole central banking conference in Wyoming that the Fed would increases the cash rate as high as needed to cool down the overheating economy, and keep them there for a certain period of time in order to lower inflation running at more than three times the Fed’s 2% goal. Shifting the focus to the other currency market, the Europe zone’s single currency jumped as ECB policymakers made the case on Saturday a sharp rise in interest rates next month as inflation remains at a sky-high level while the public is losing trust in the bank’s ability to fight inflation. Following a rate hike of 50 basis points last month, ECB is expected to have a similar or larger move on 8th September meeting. Looking ahead, investors will put their attention over the upcoming crucial data, such as the CB Consumer Confidence, to have a gauge on the consumer spending in the near future. As of writing, the dollar index dropped -0.05% to 108.75.

In the commodities market, the crude oil price was down by -0.26% to $96.72 a barrel as potential OPEC+ output cuts outweigh the consequence of strong US dollar and dire global economic outlook. Besides, the gold prices edged up by 0.04% to $1736.90 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Aug) | 95.7 | 97.9 | – |

| 22:00 | USD – JOLTs Job Openings (Jul) | 10.698M | 10.475M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 108.50. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0000. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 138.00. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 139.35.

Resistance level: 139.35, 140.50

Support level: 138.00, 136.65

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6245.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2985. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 96.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 98.20.

Resistance level: 98.20, 100.65

Support level: 96.00, 93.15

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

290822 Afternoon Session Analysis

29 August 2022 Afternoon Session Analysis

Euro dived despite hawkish statement from ECB.

The EUR/USD, which traded by majority of investors dropped significantly although the ECB members released their hawkish speech. According to Reuters, European Central Bank (ECB) board member Isabel Schnabel claimed on Saturday that the central banks would raise its interest rate forcefully to tamp down the inflation back to 2%, even the economy was in recession. Besides, ECB policymaker Martins Kazaks also unleashed his point of view that both 50 and 75 basis point rate hike should be on the table. Nonetheless, the EUR/USD retraced from the 1.0000 level following the hawkish statement from Federal Reserve Chairman Jerome Powell. As of now, investors would continue to scrutinize the Eurozone CPI data which will be announced on Wednesday in order to anticipate the interest rate decision from ECB. Currently, the economist expected that the Eurozone CPI would increase from the prior figure of 8.9% to 9.0%. As of writing, EUR/USD depreciated by 0.35% to 0.9926.

In the commodities market, the crude oil price rose by 1.18% to $94.17 per barrel as of writing over the hopes of a supply cut by the OPEC. On the other hand, the gold price eased by 0.68% to $1726.45 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1740, 1.1820

Support level: 1.1660, 1.1595

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9935, 1.0005

Support level: 0.9860, 0.9810

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 140.70

Support level: 137.55, 136.50

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9755, 0.9840

Support level: 0.9680, 0.9595

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 94.40, 97.90

Support level: 91.50, 87.95

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1731.55, 1756.85

Support level: 1712.80, 1693.65