290822 Morning Session Analysis

29 August 2022 Morning Session Analysis

Jerome Powell signaled aggressive rate hike plan to continue.

The dollar index, which gauges its value against a basket of six major currencies, extended its gains with a large step before the market entered the weekend as Federal Reserve Chairman Jerome Powell vowed that aggressive rate hikes will be continued at this point in time. During the Jackson Hole Symposium, Jerome Powell finally presented his long-awaited view on the rate hike plan, whereby he said that the central bank’s job of cooling down the overheating economy is not done yet, mirroring that the Fed will not back off from increasing the interest rate aggressively. Besides, Jerome Powell warned that “in order to restore the price stability, it will likely require maintaining a restrictive policy stance for some time as the historical record cautions strongly against easing the policy too soon.” Powell also revealed that the economy needed more rate hikes, with “another unusually large” increase still on the table for the next meeting. Following the hawkish statement from the Chairman of the Fed, the possibility of a 75-basis point of a rate hike in the upcoming September meeting jumped from the prior week’s reading of 47.0% to 61.0%. As of writing, the dollar index is up 0.18% to 109.00.

In the commodities market, the crude oil price was down by 0.02% to $92.77 a barrel amid the aggressiveness of the Fed Chairman regarding the rate hike plan exacerbated the investor worries over the risk of recession. Besides, the gold prices depreciated -by 0.16% to $1735.20 per troy ounce following the hawkish statement from Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

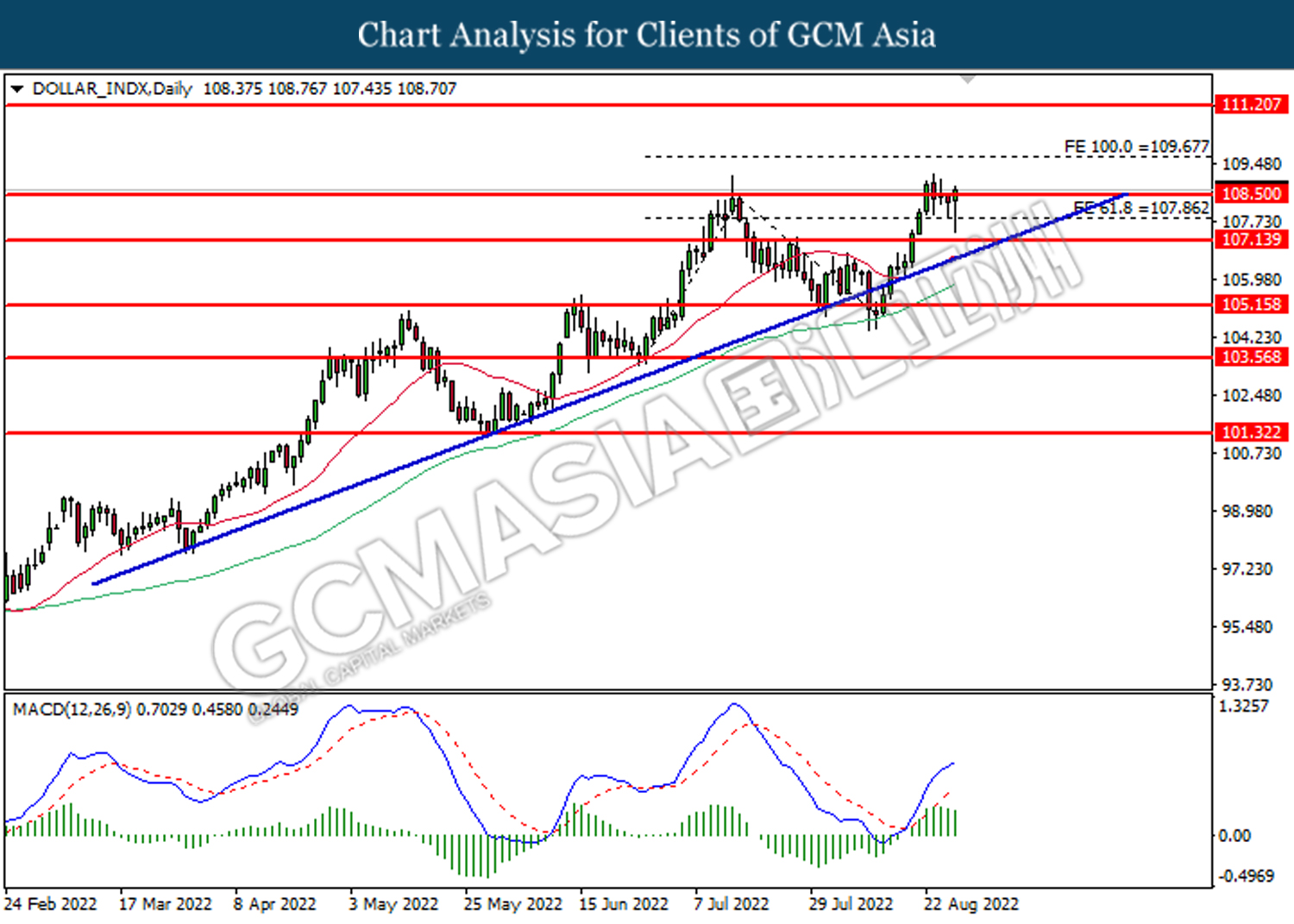

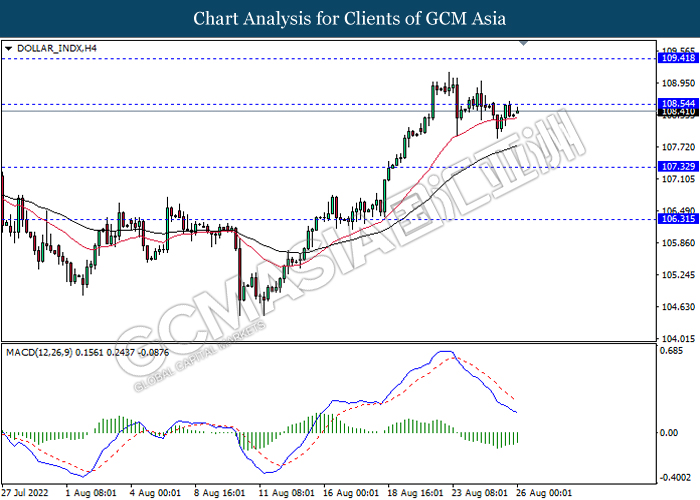

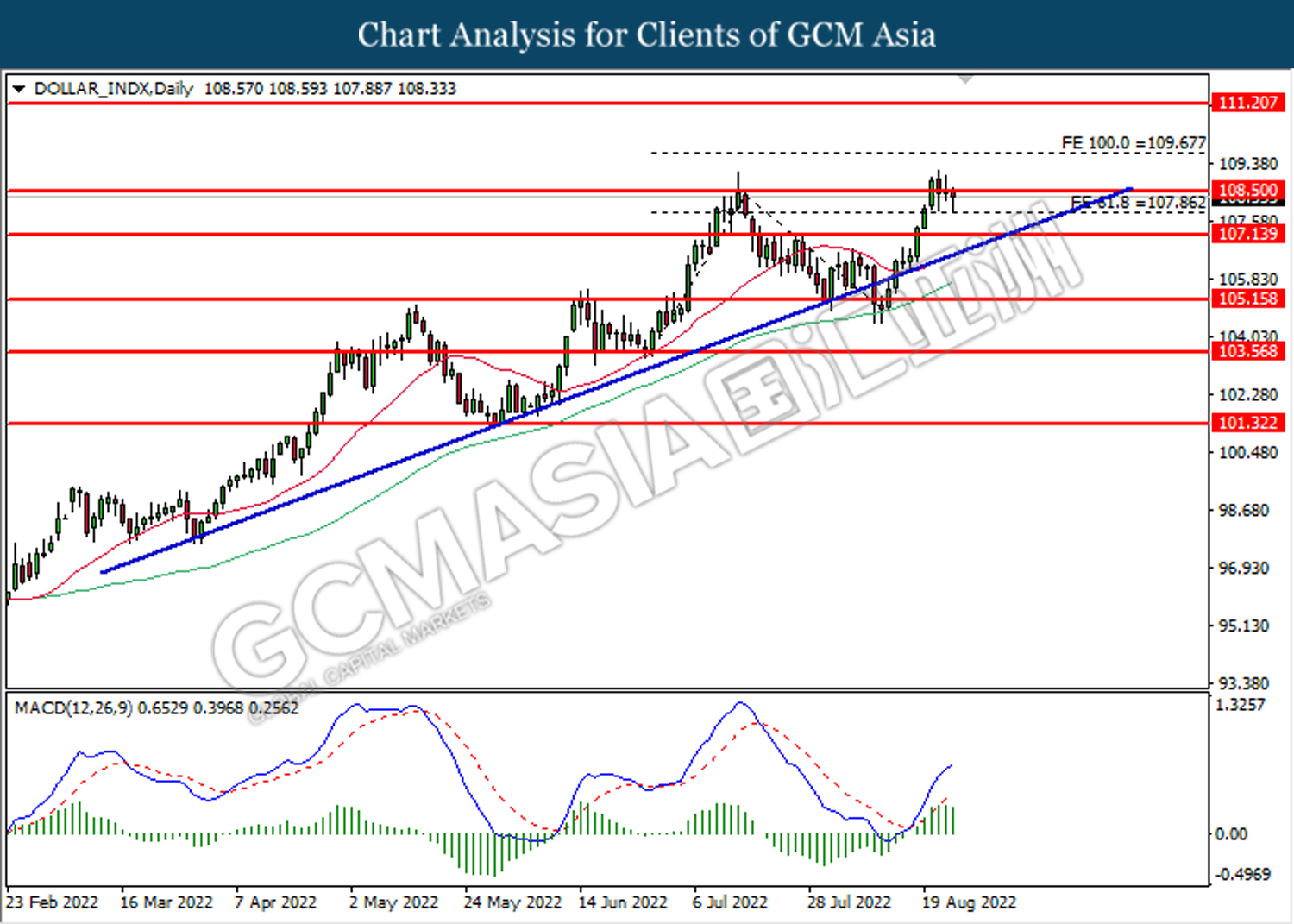

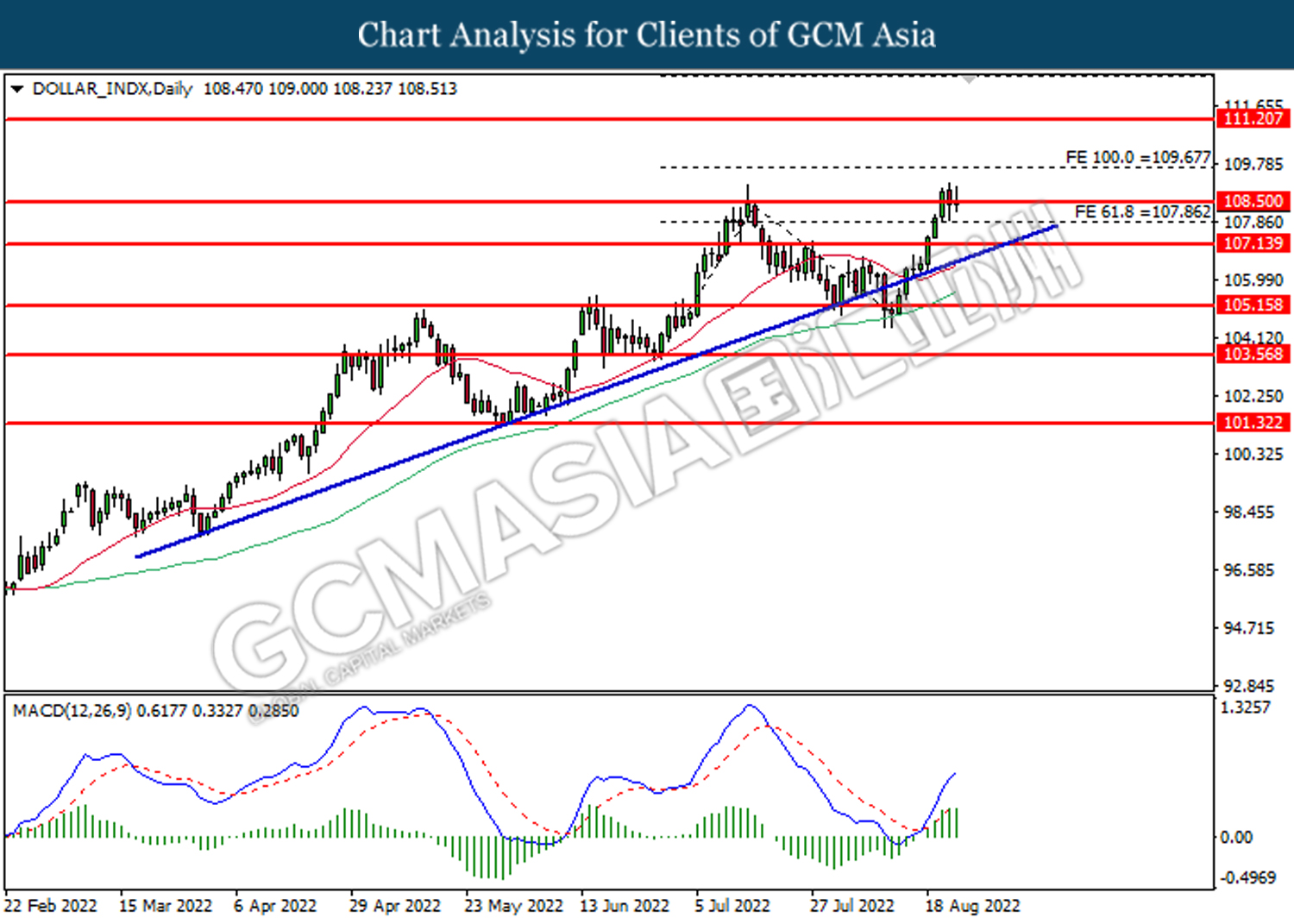

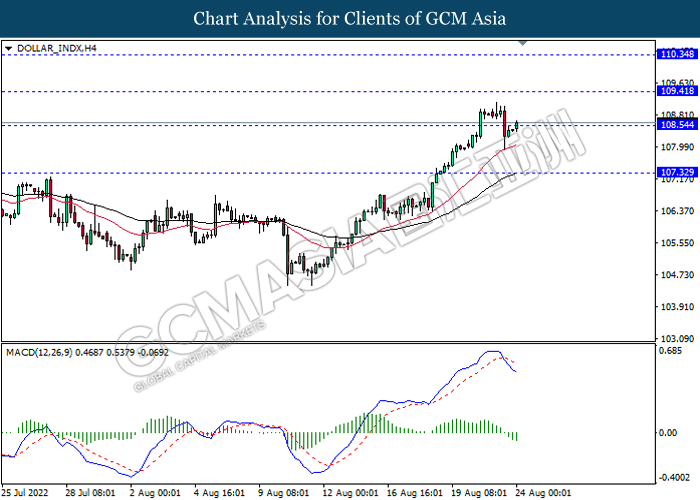

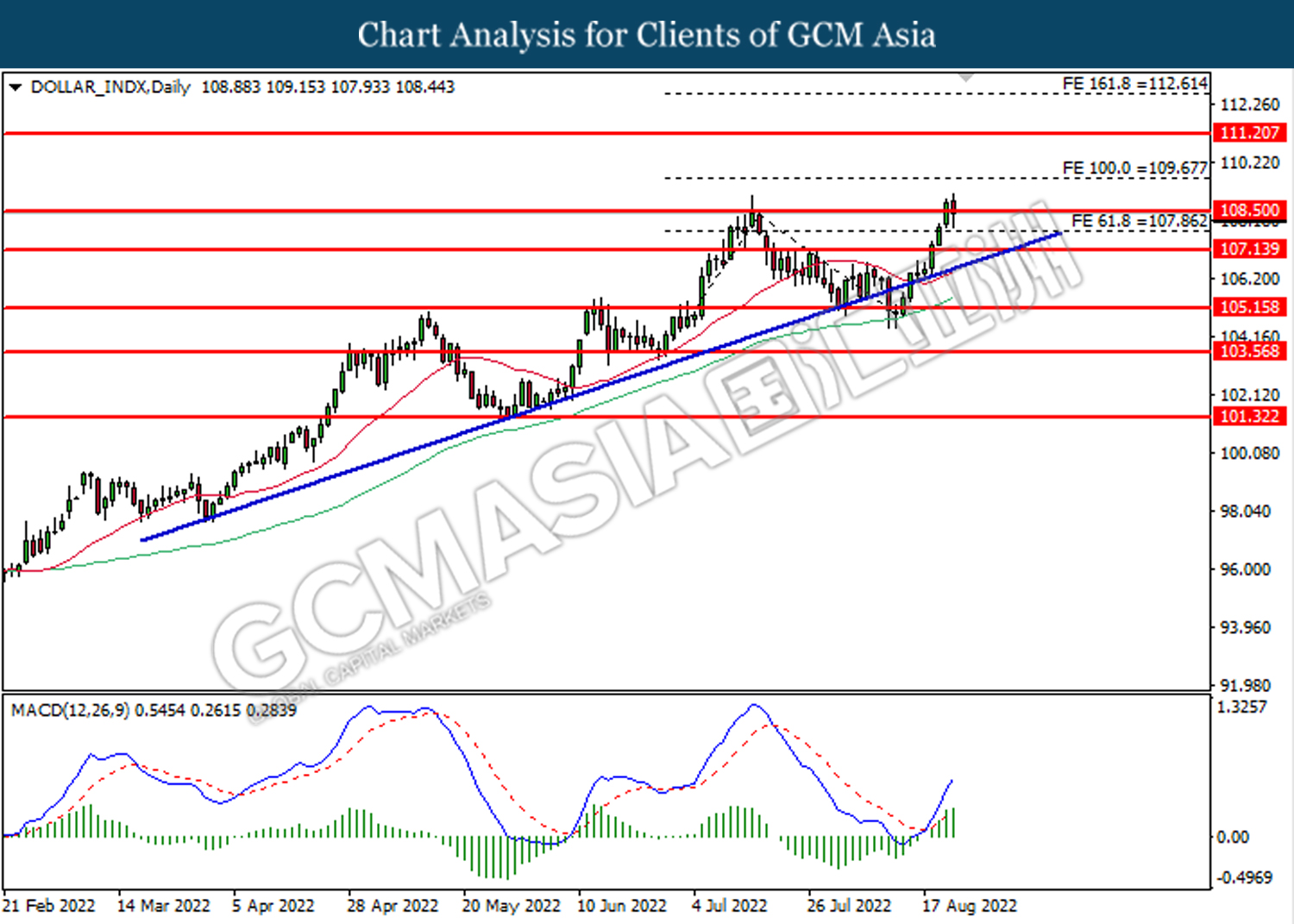

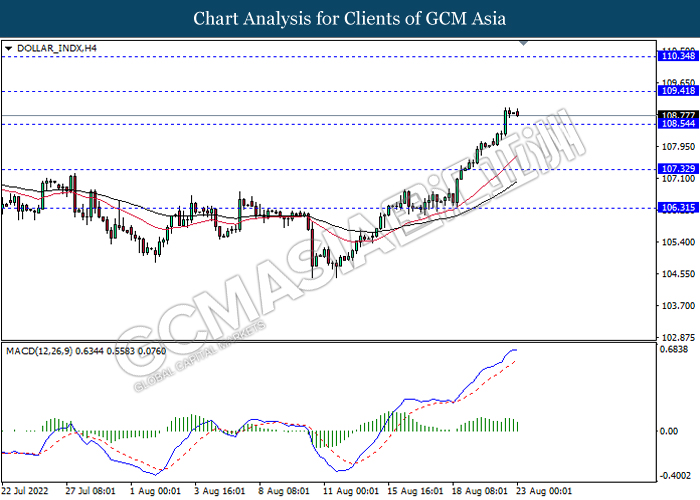

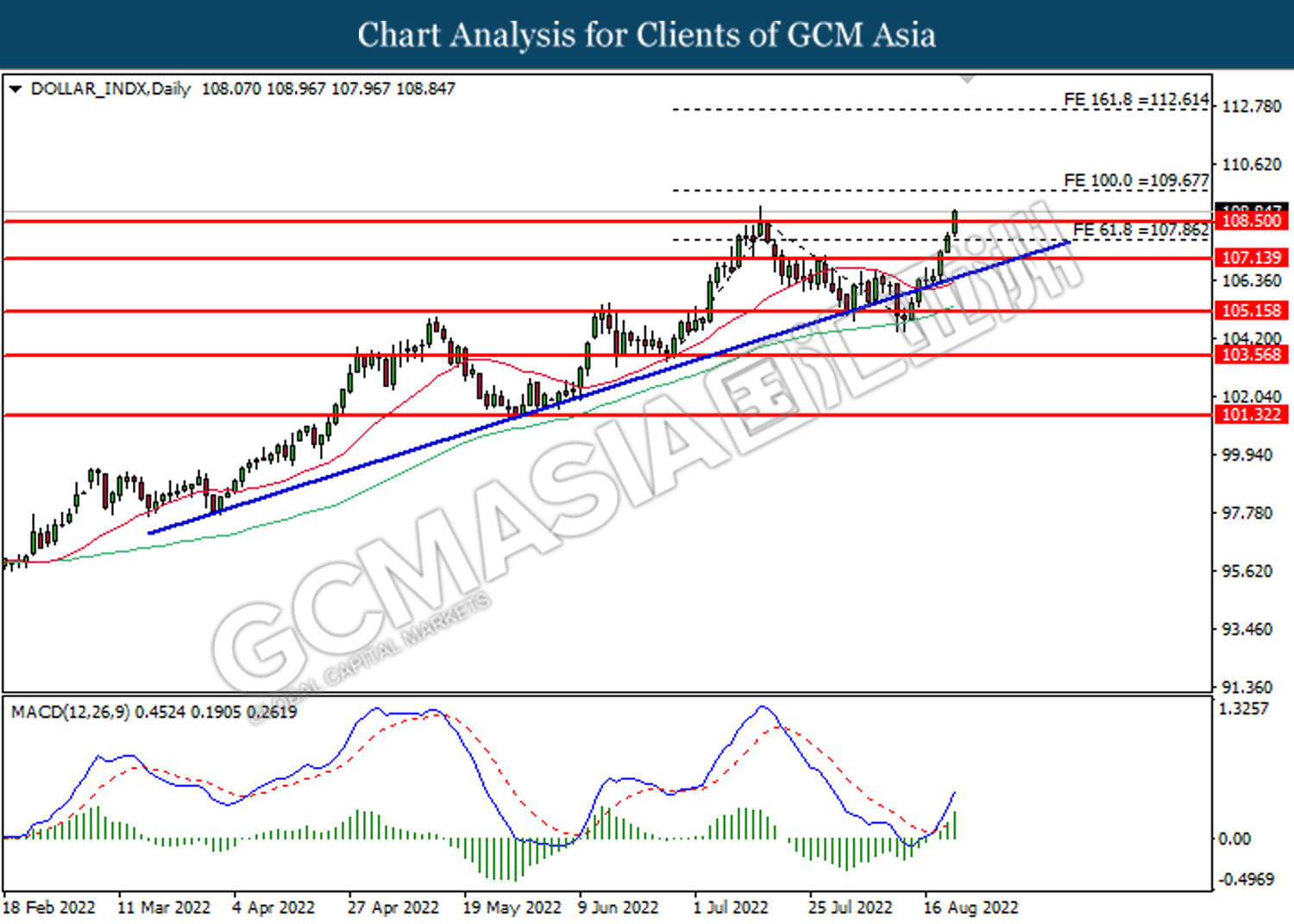

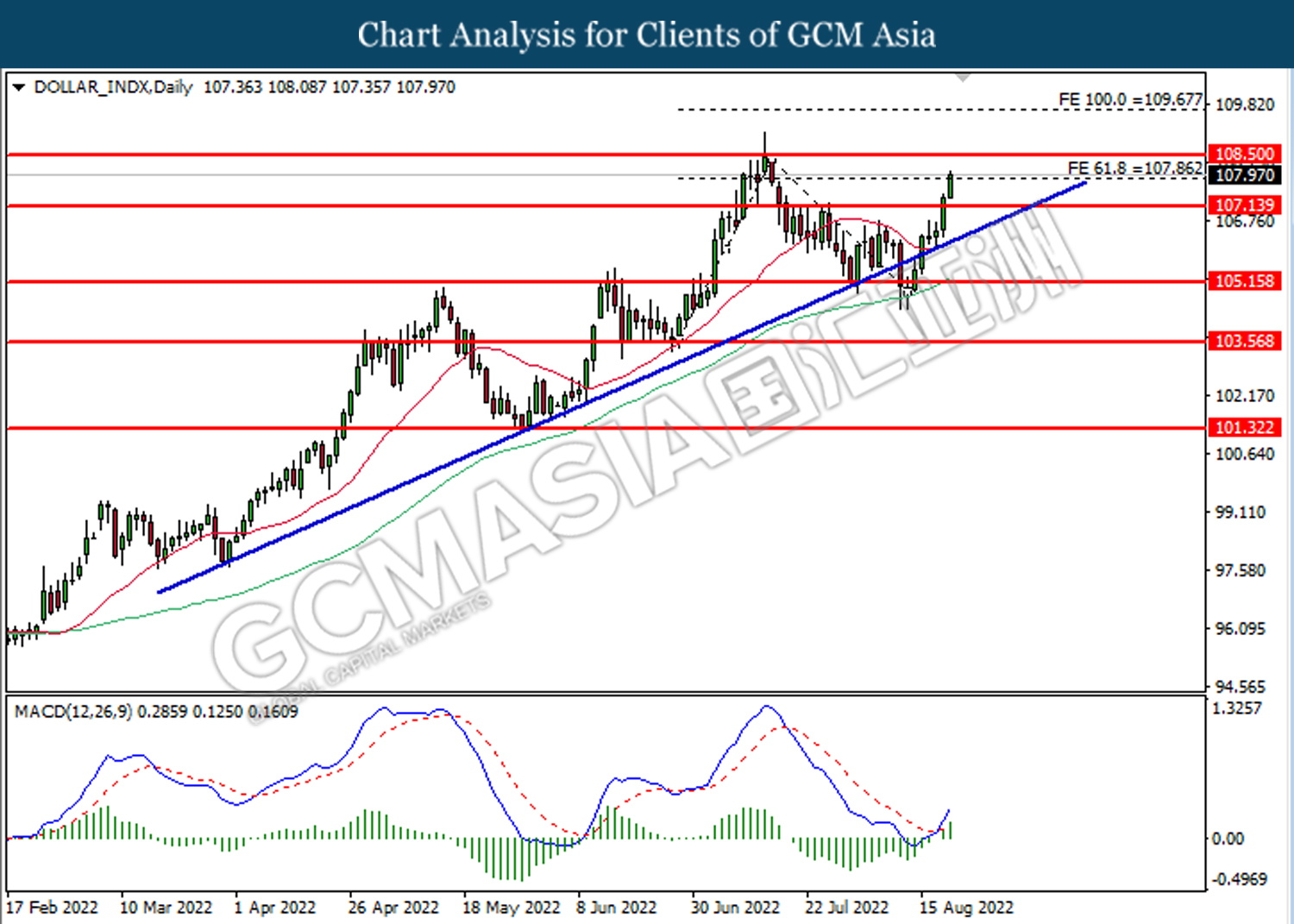

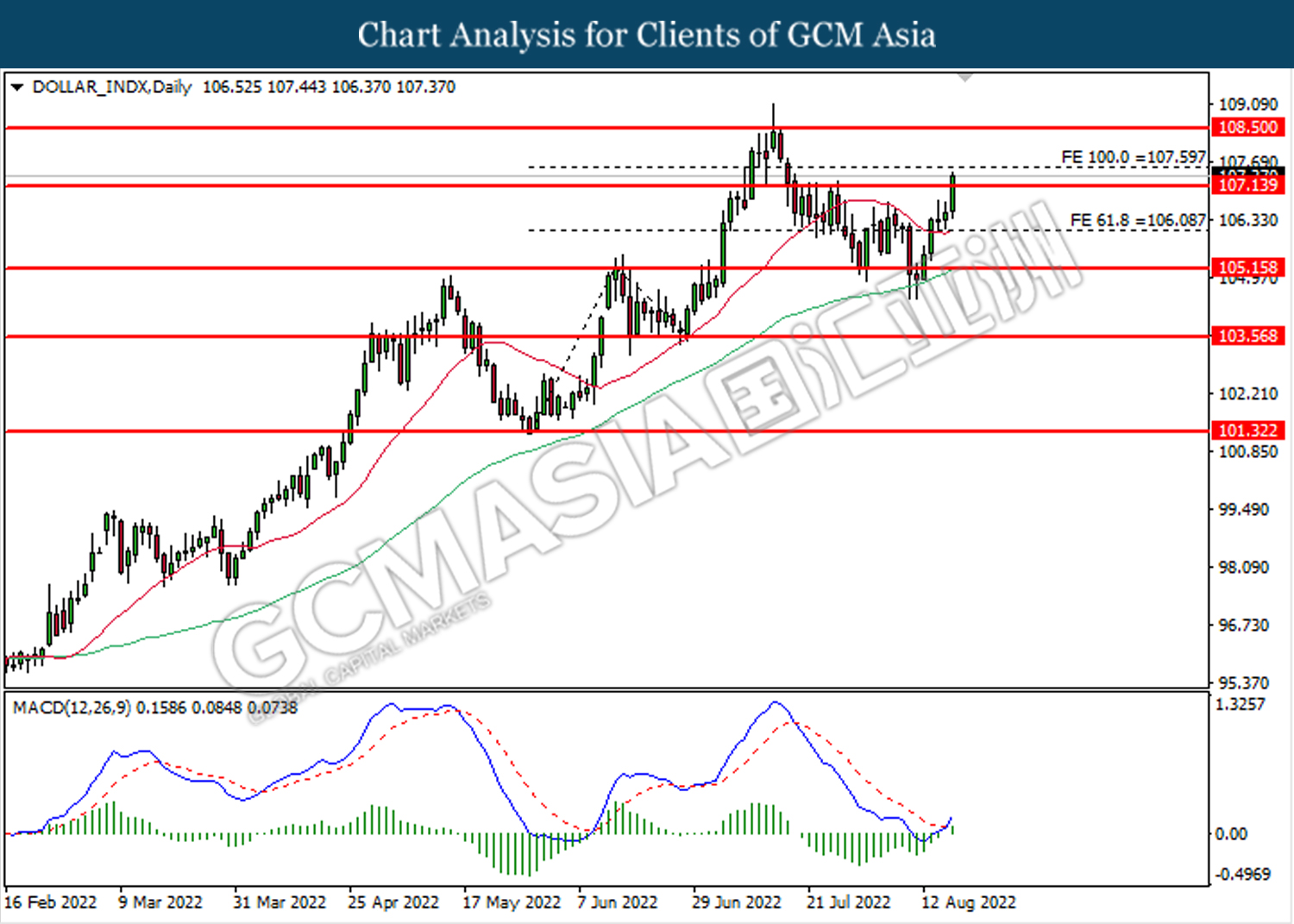

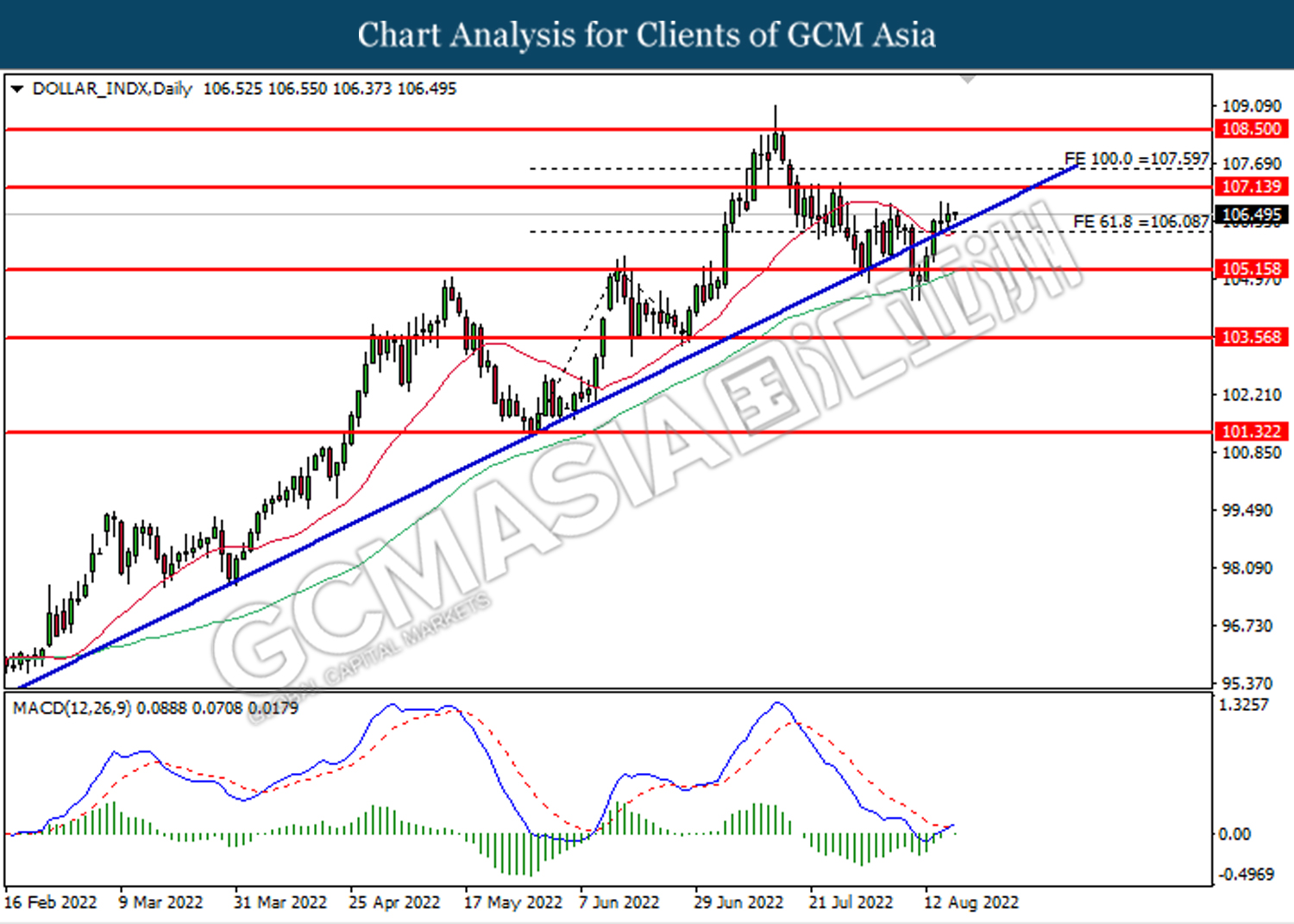

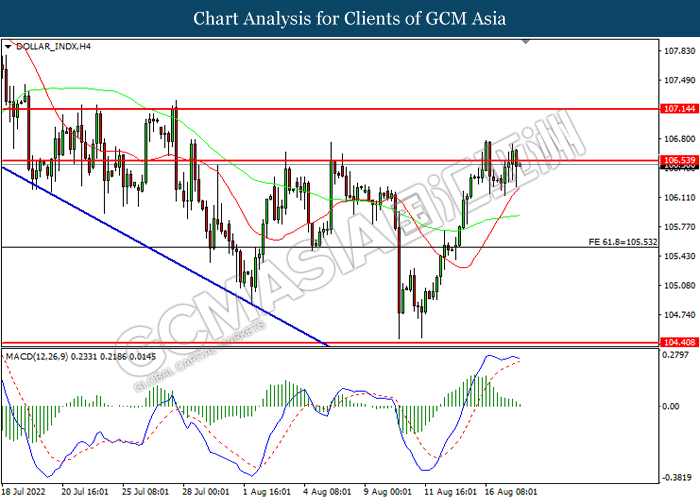

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.50, 109.65

Support level: 107.85, 107.15

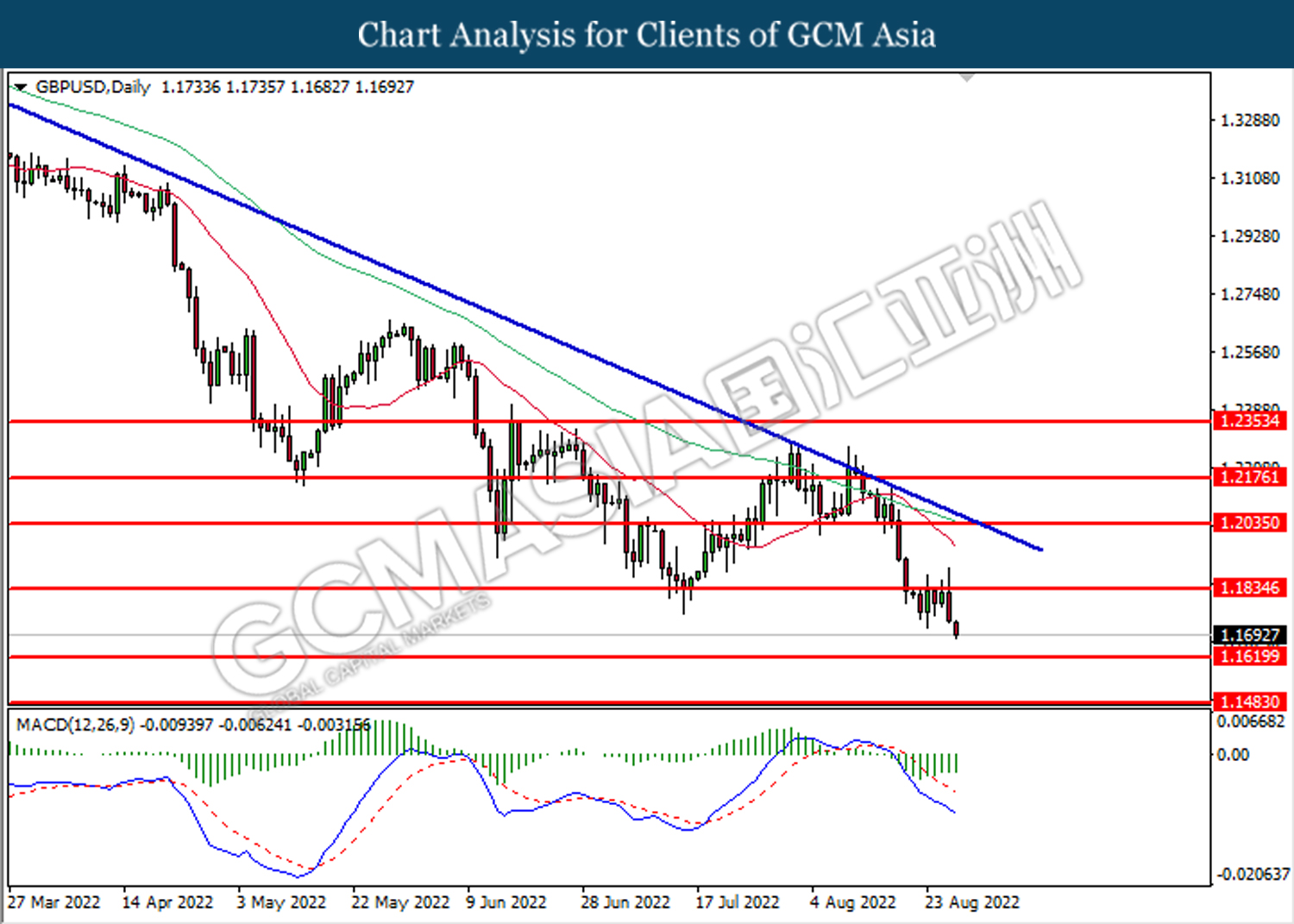

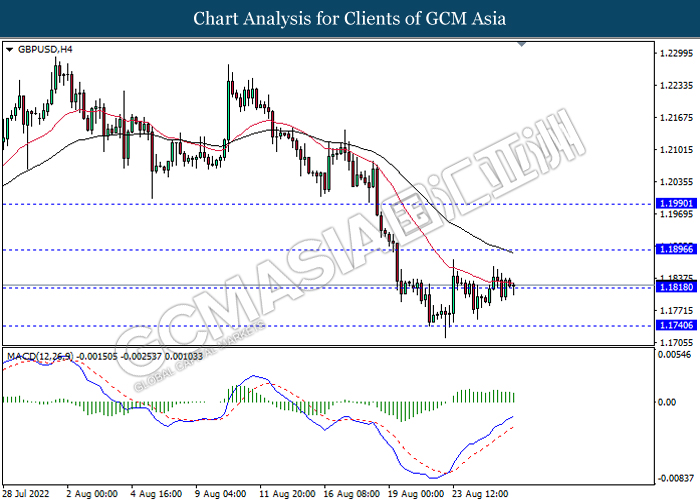

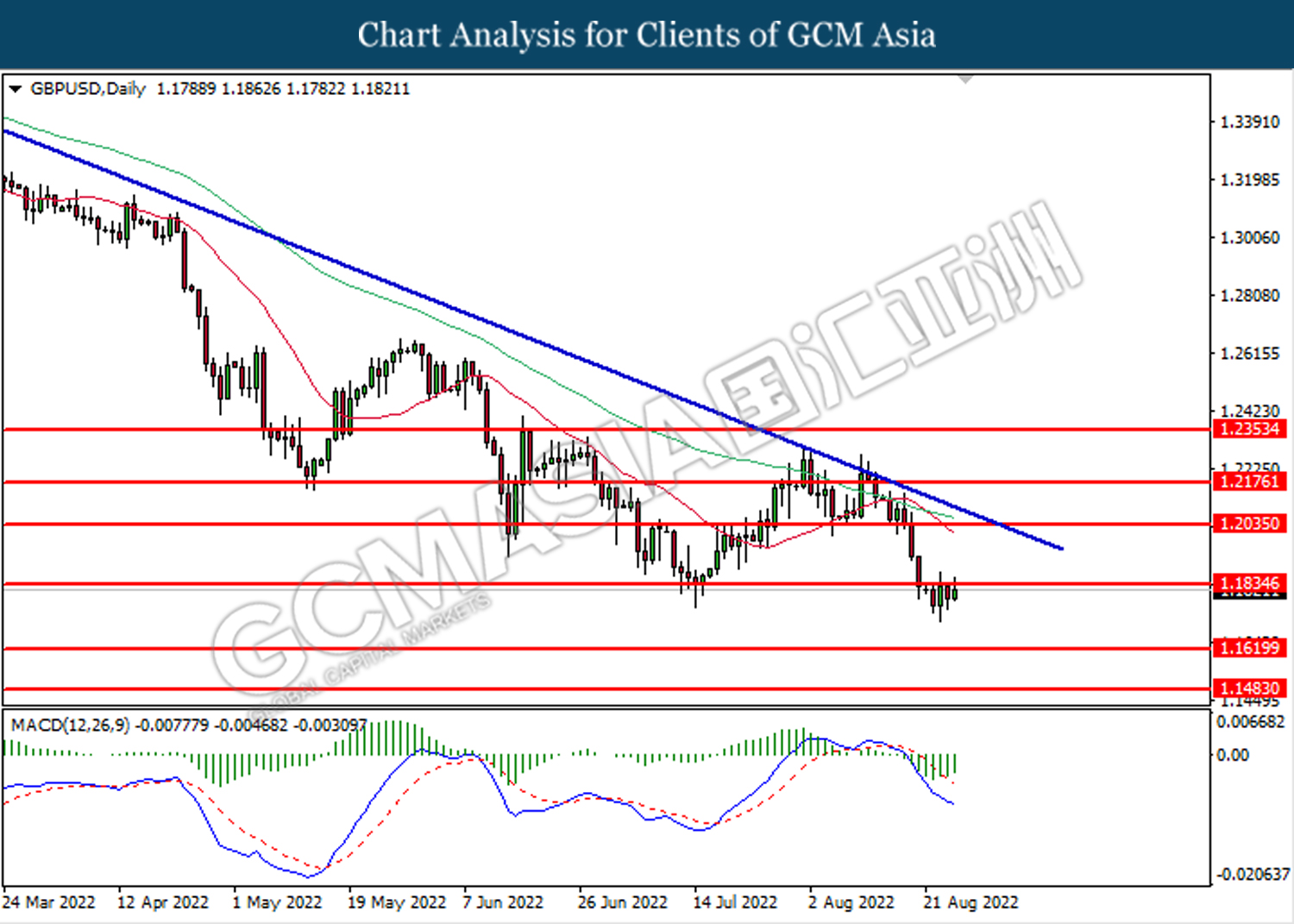

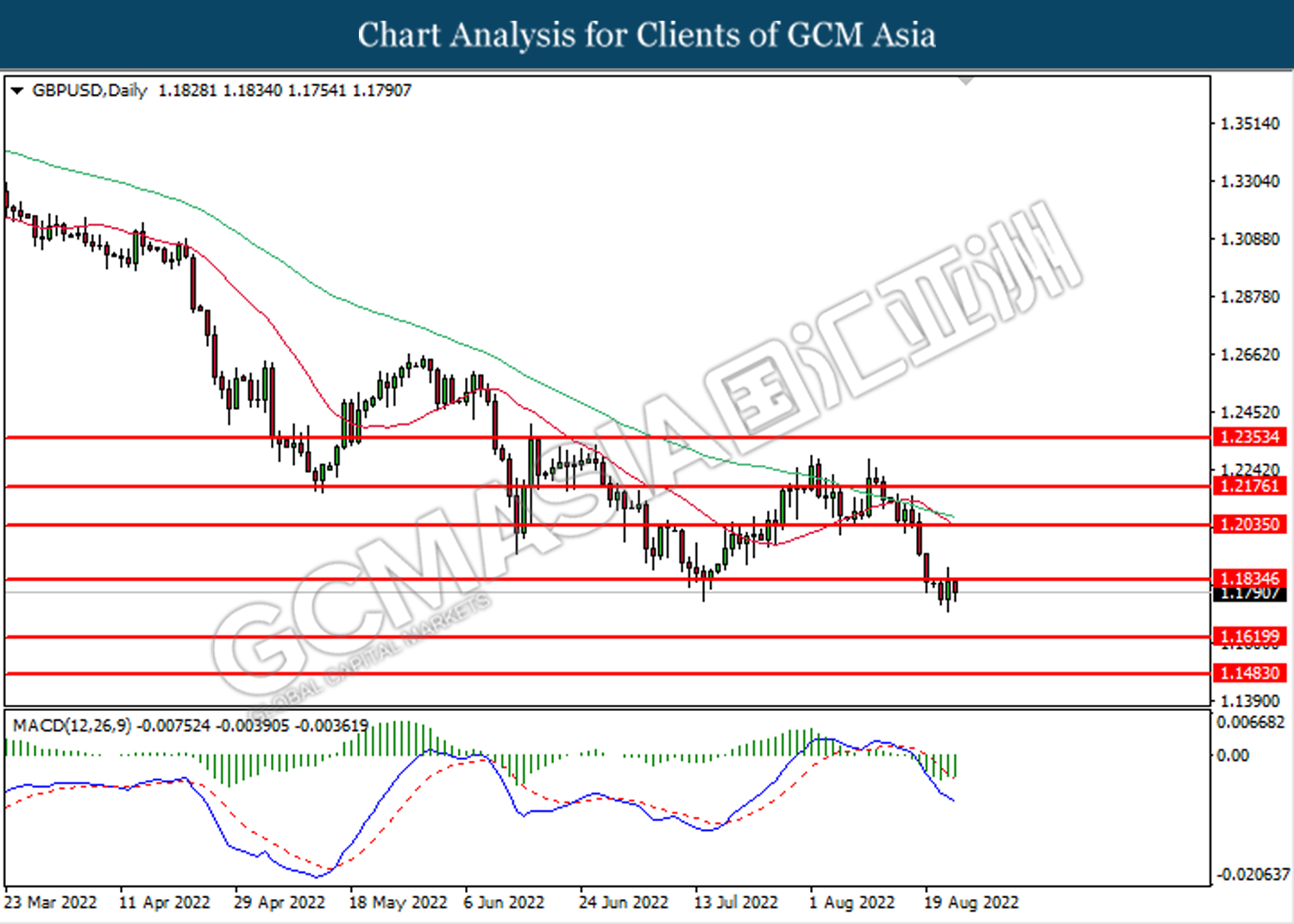

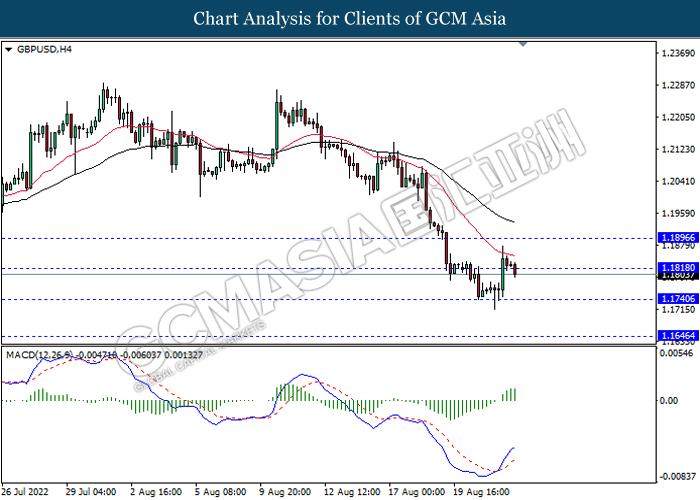

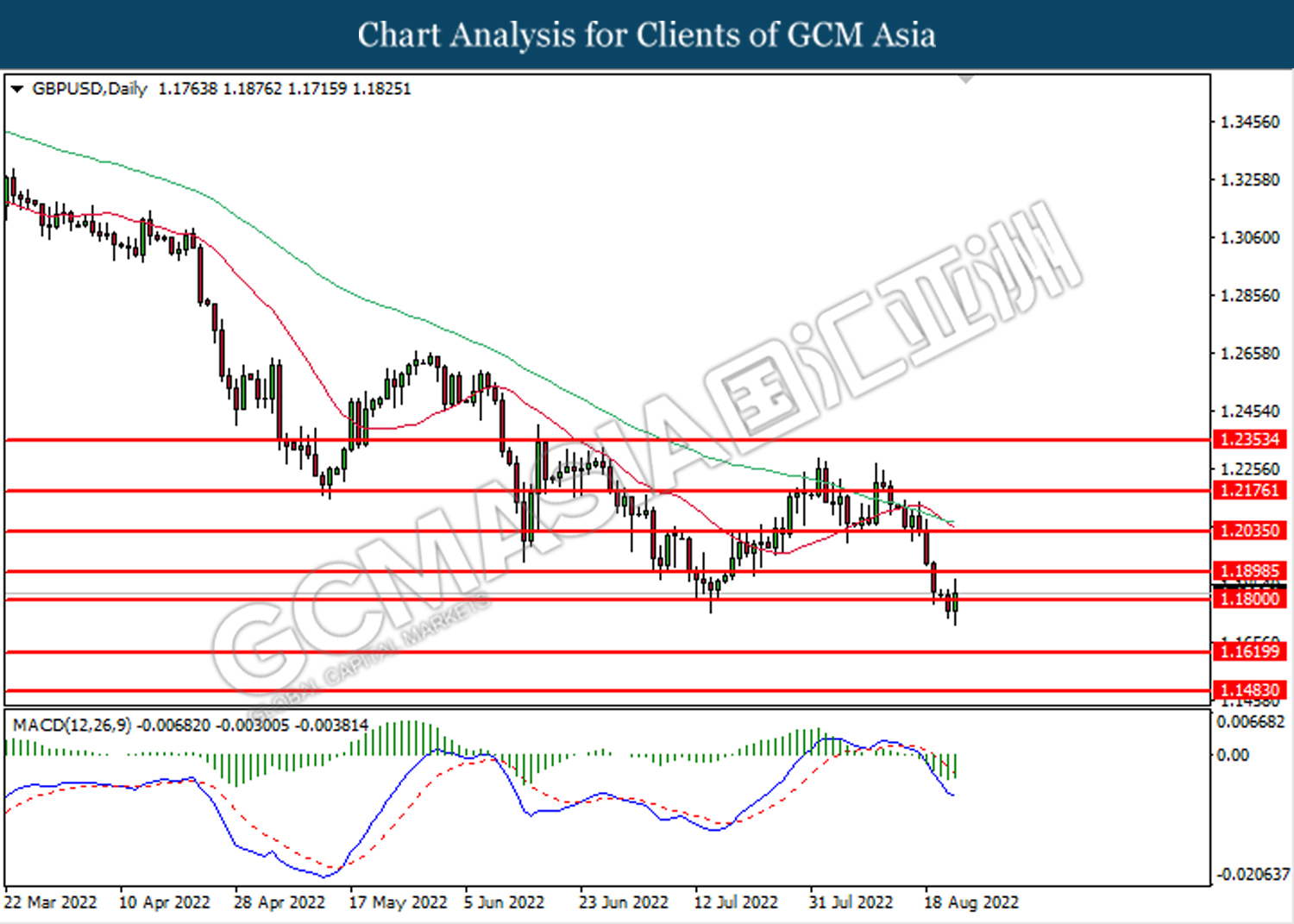

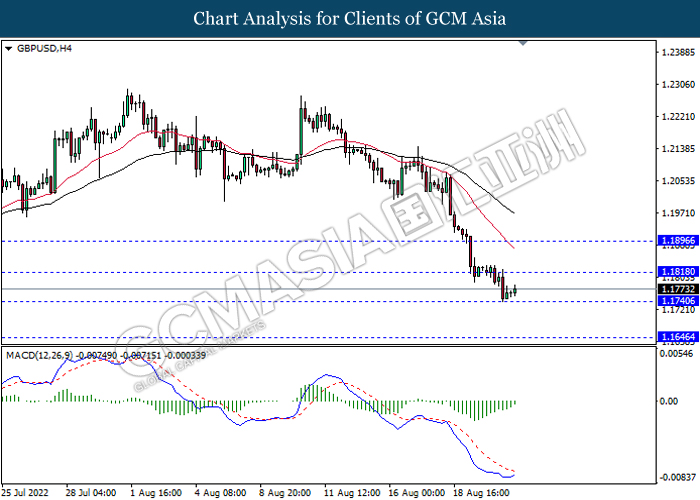

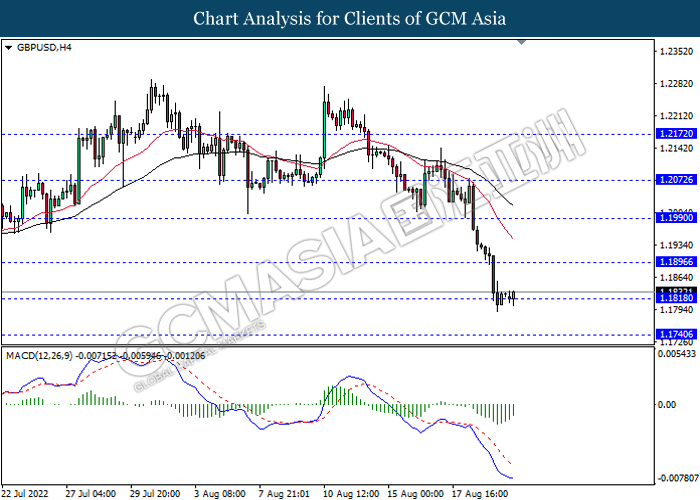

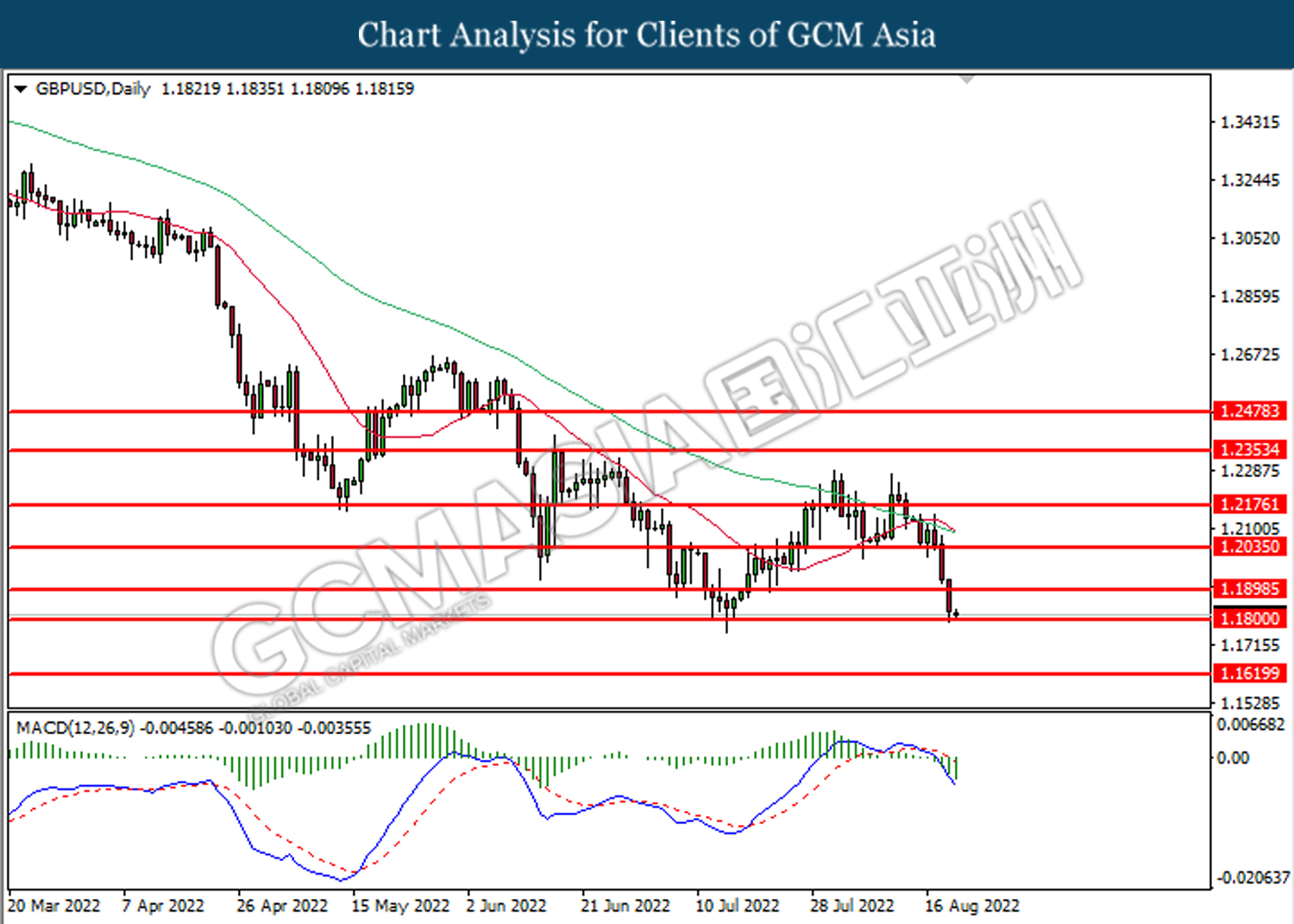

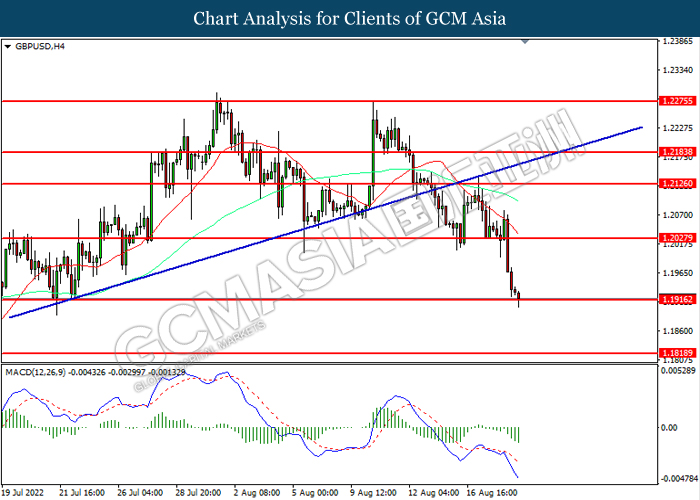

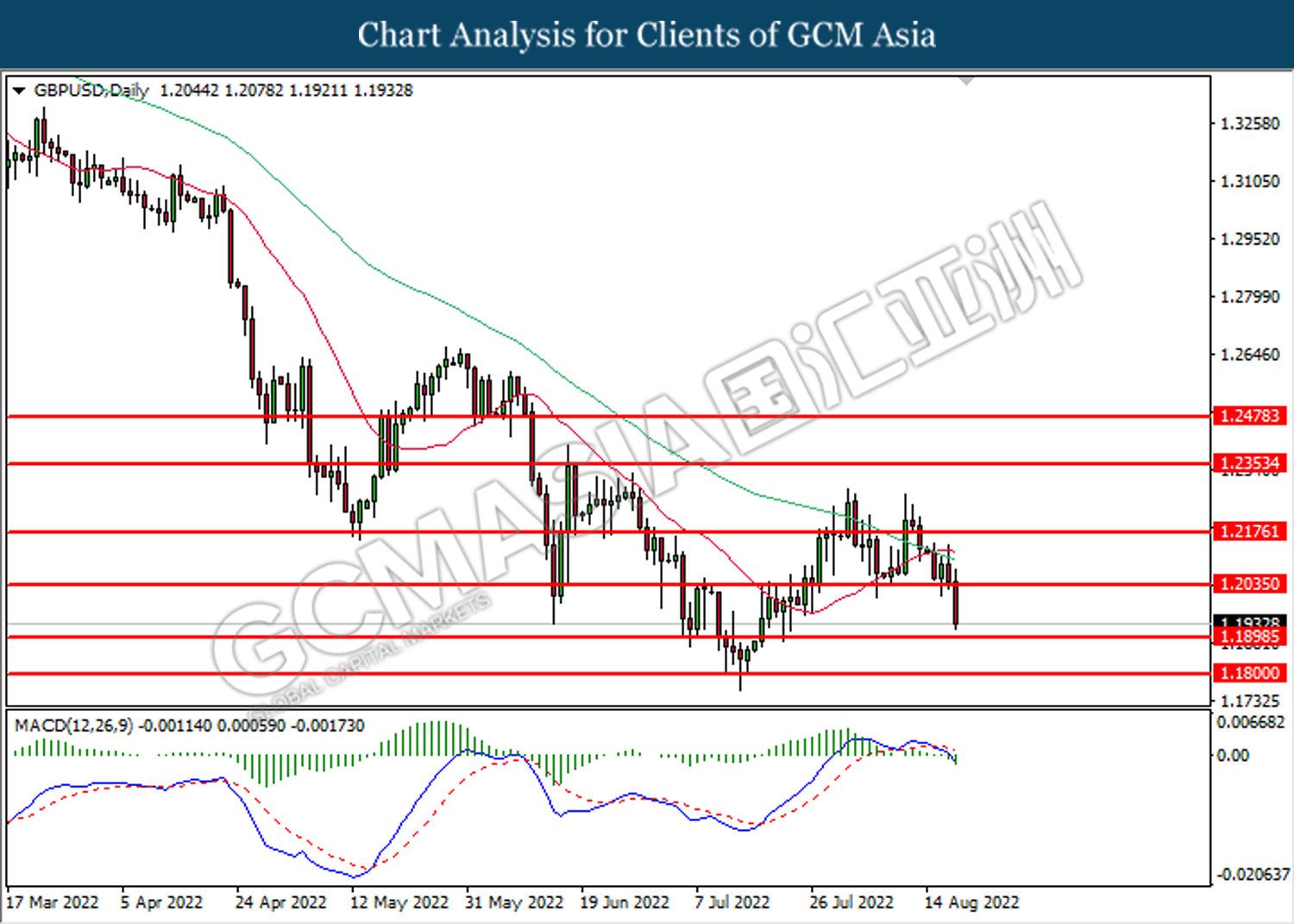

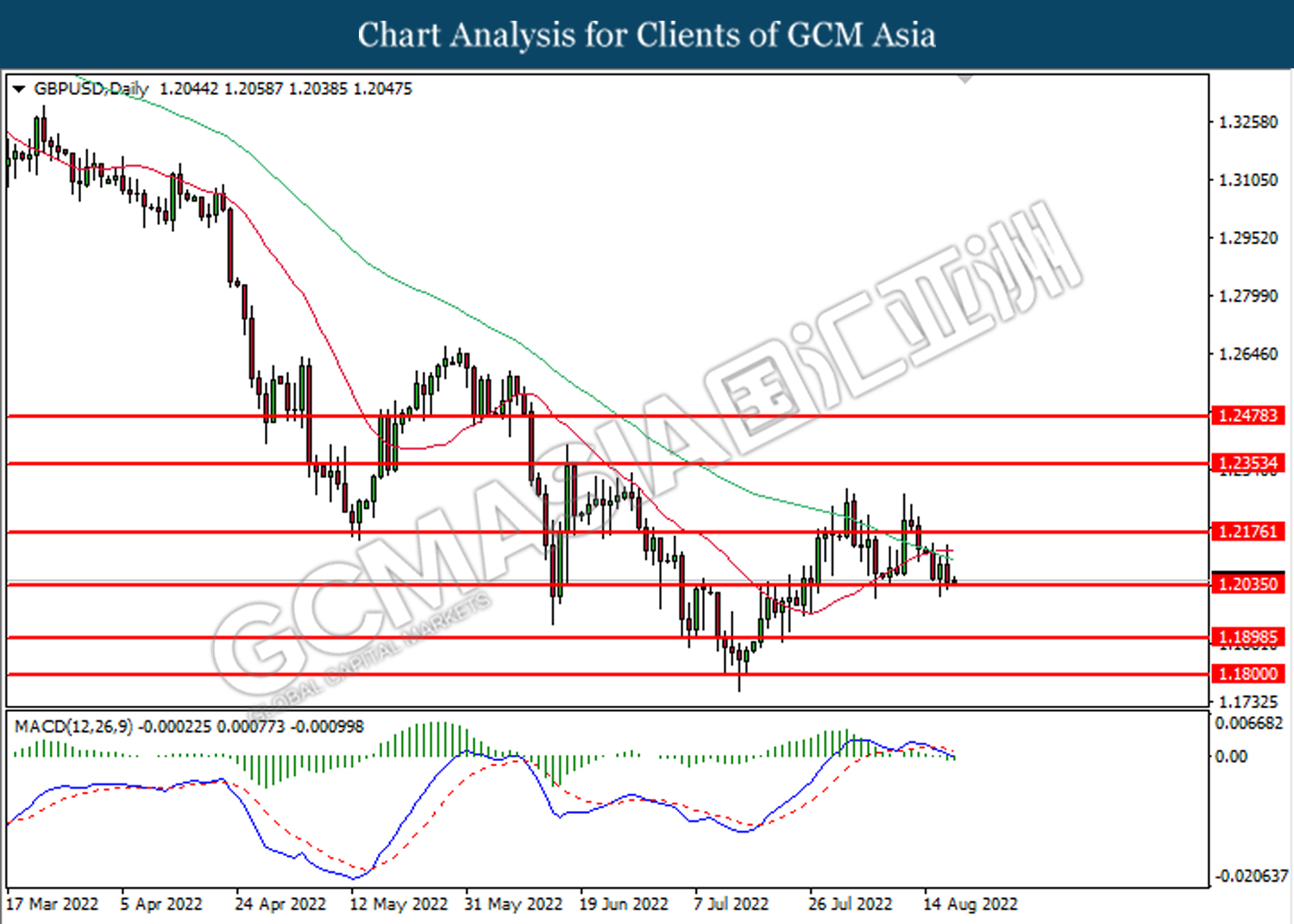

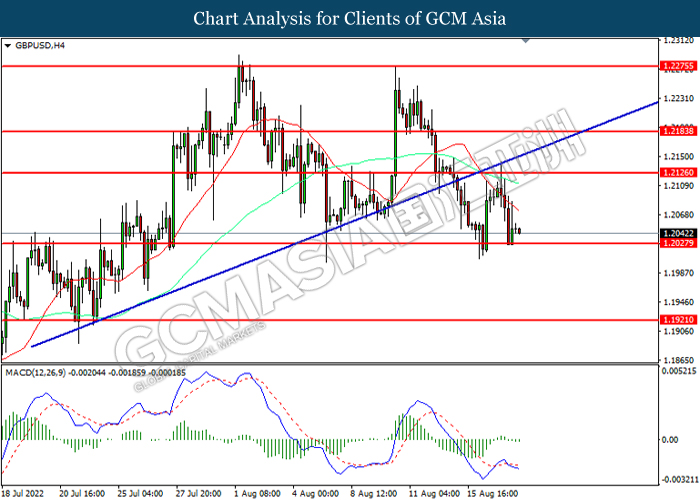

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

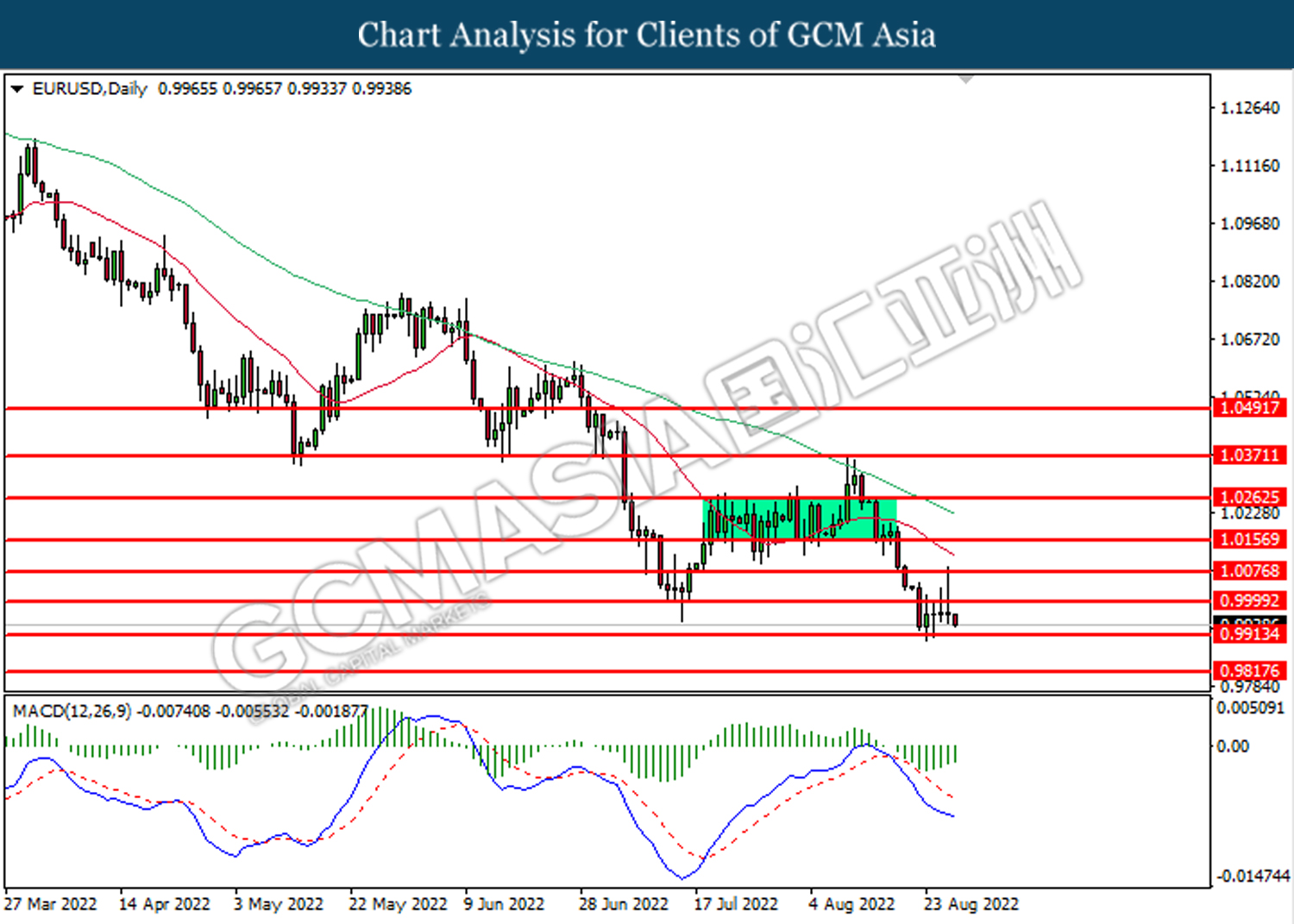

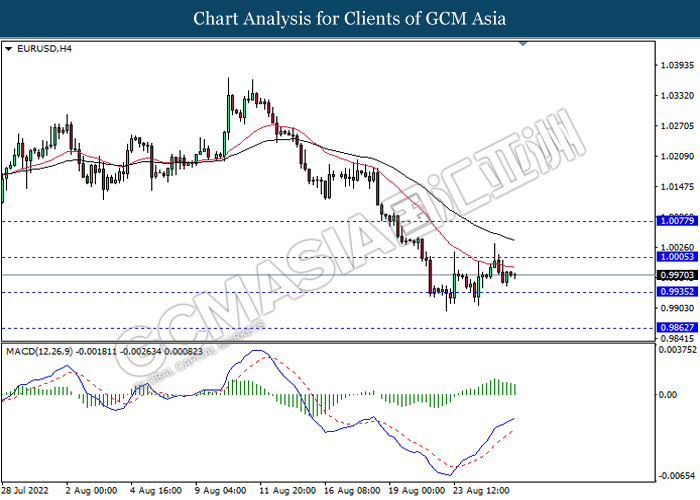

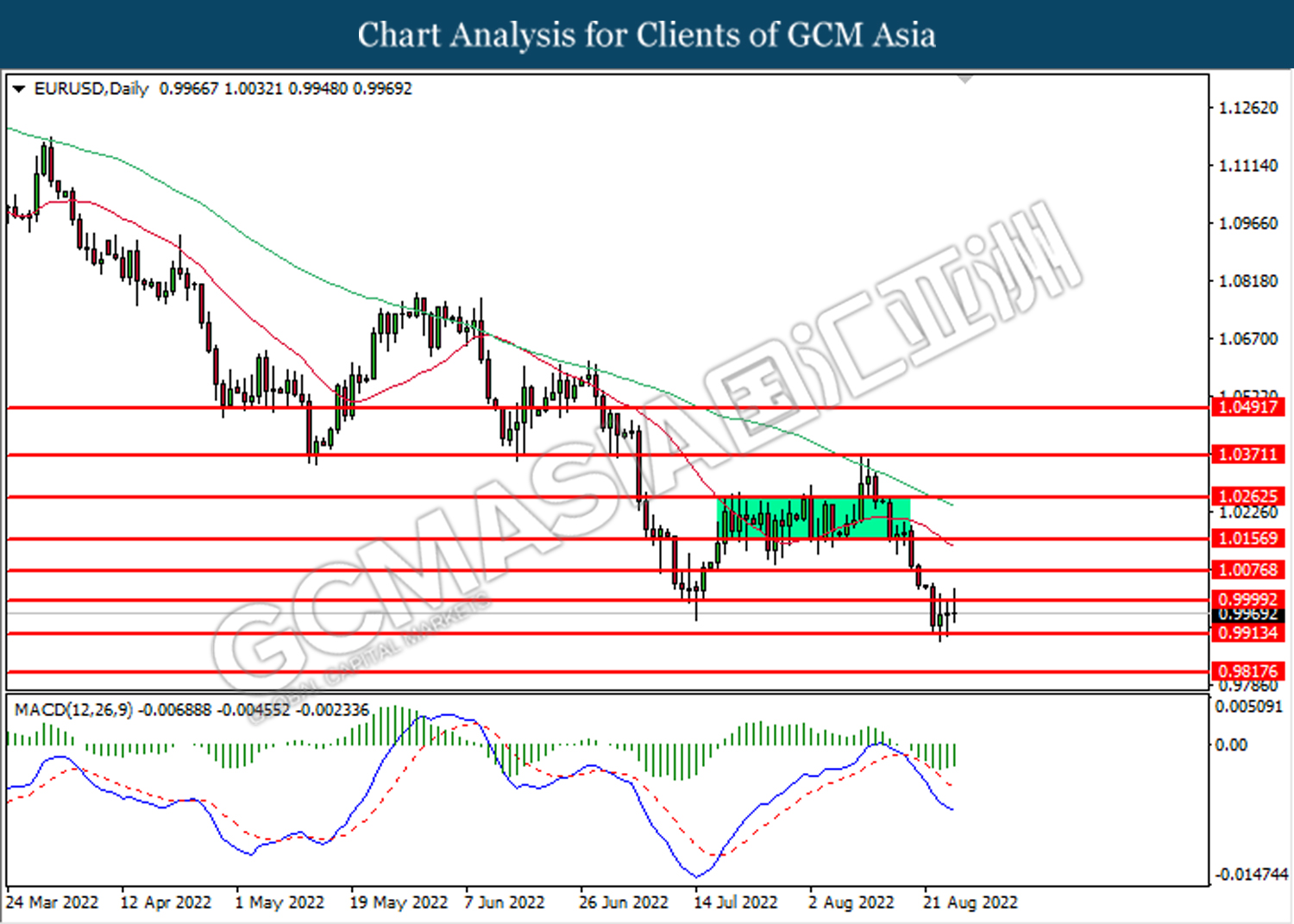

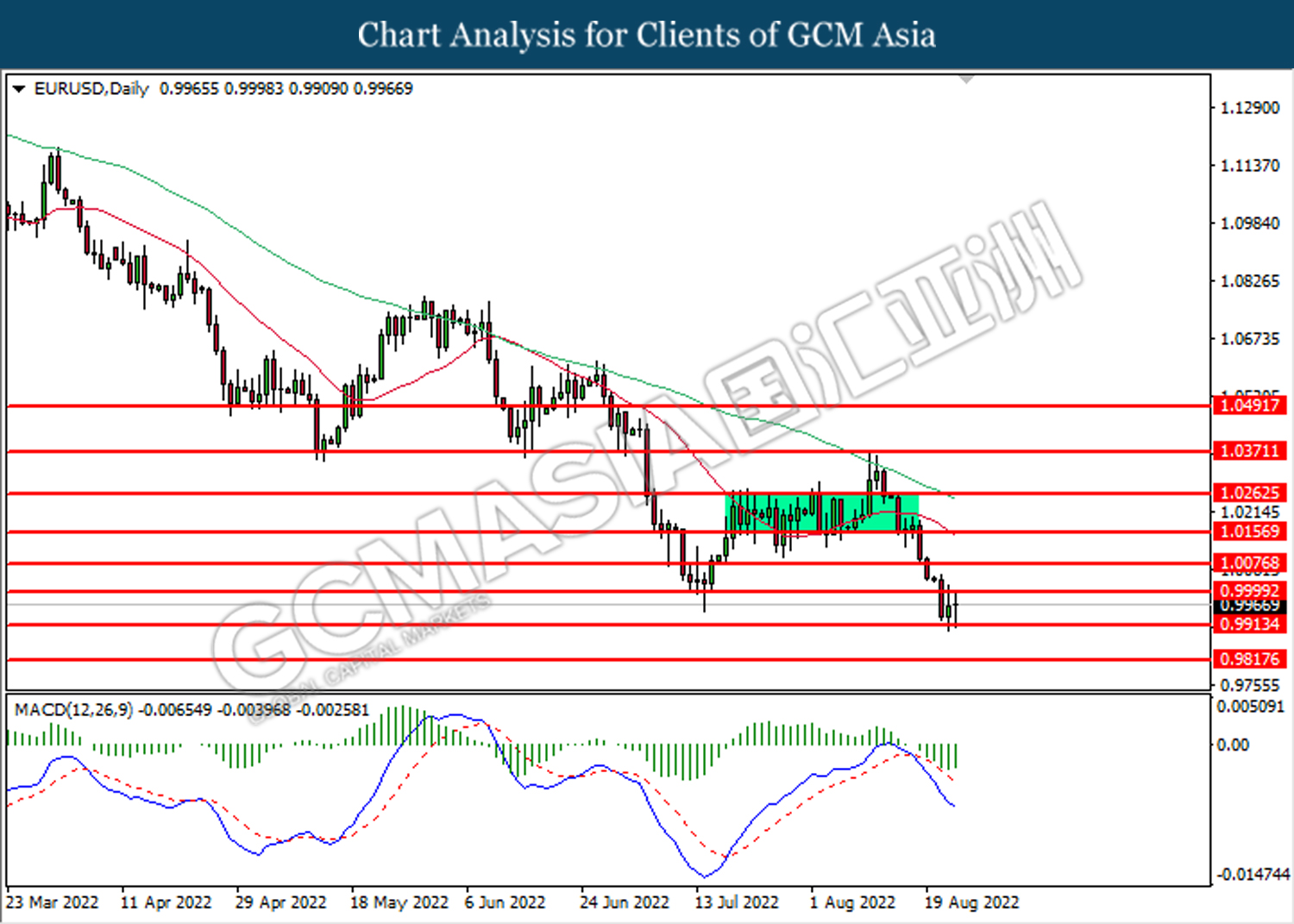

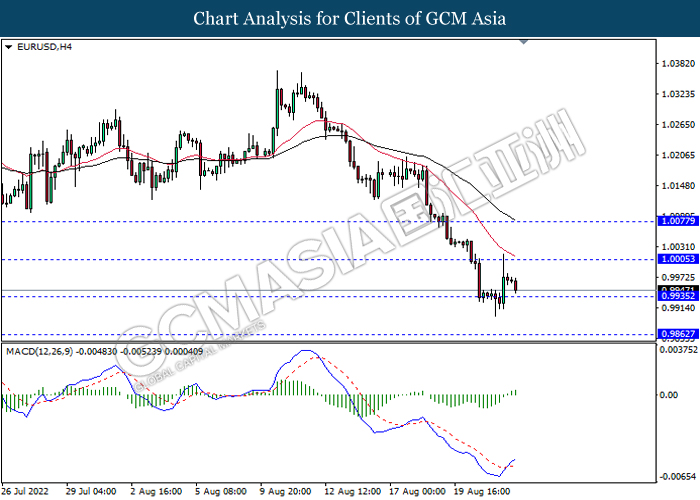

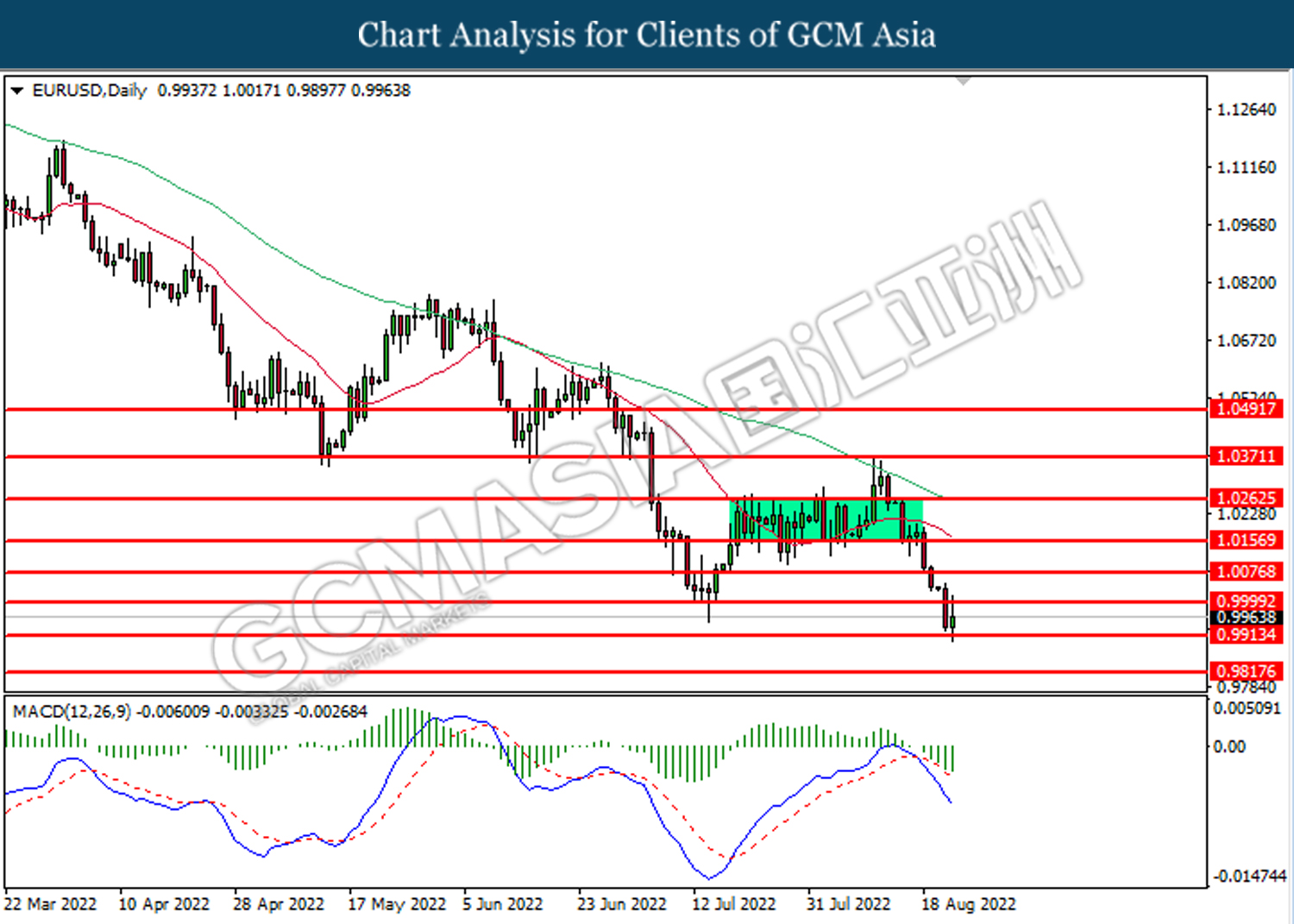

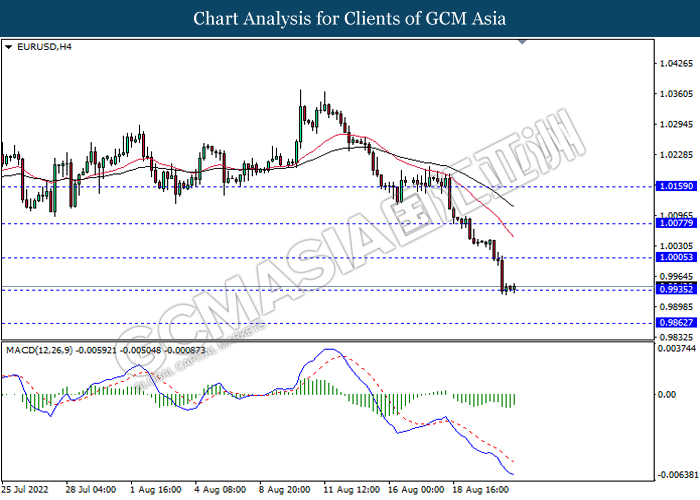

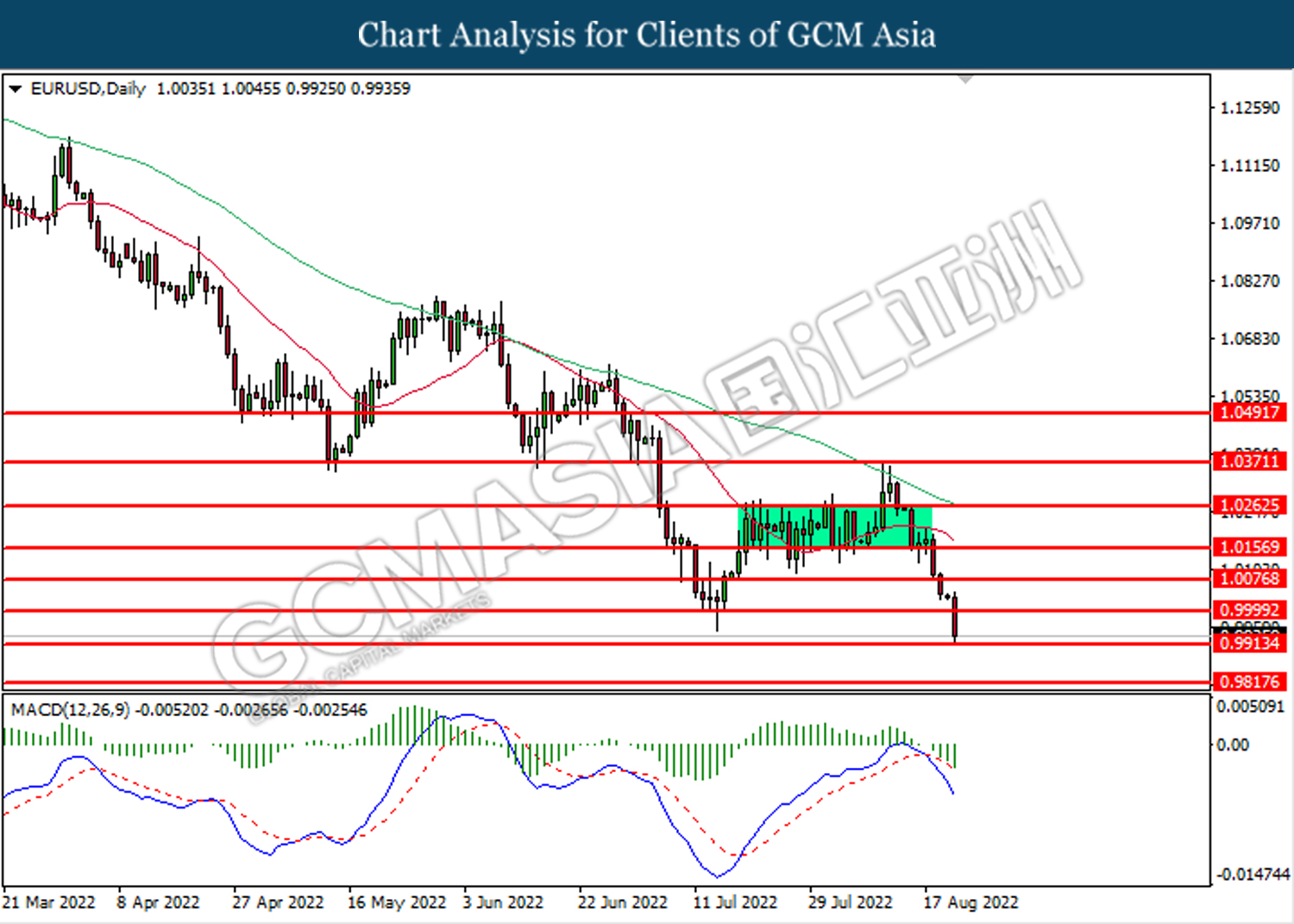

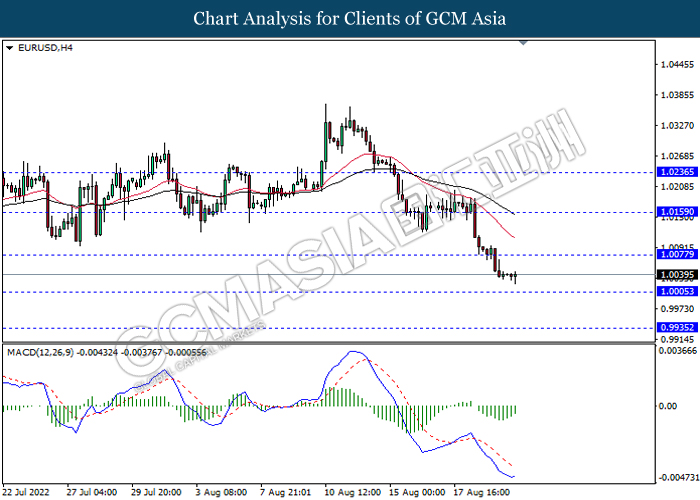

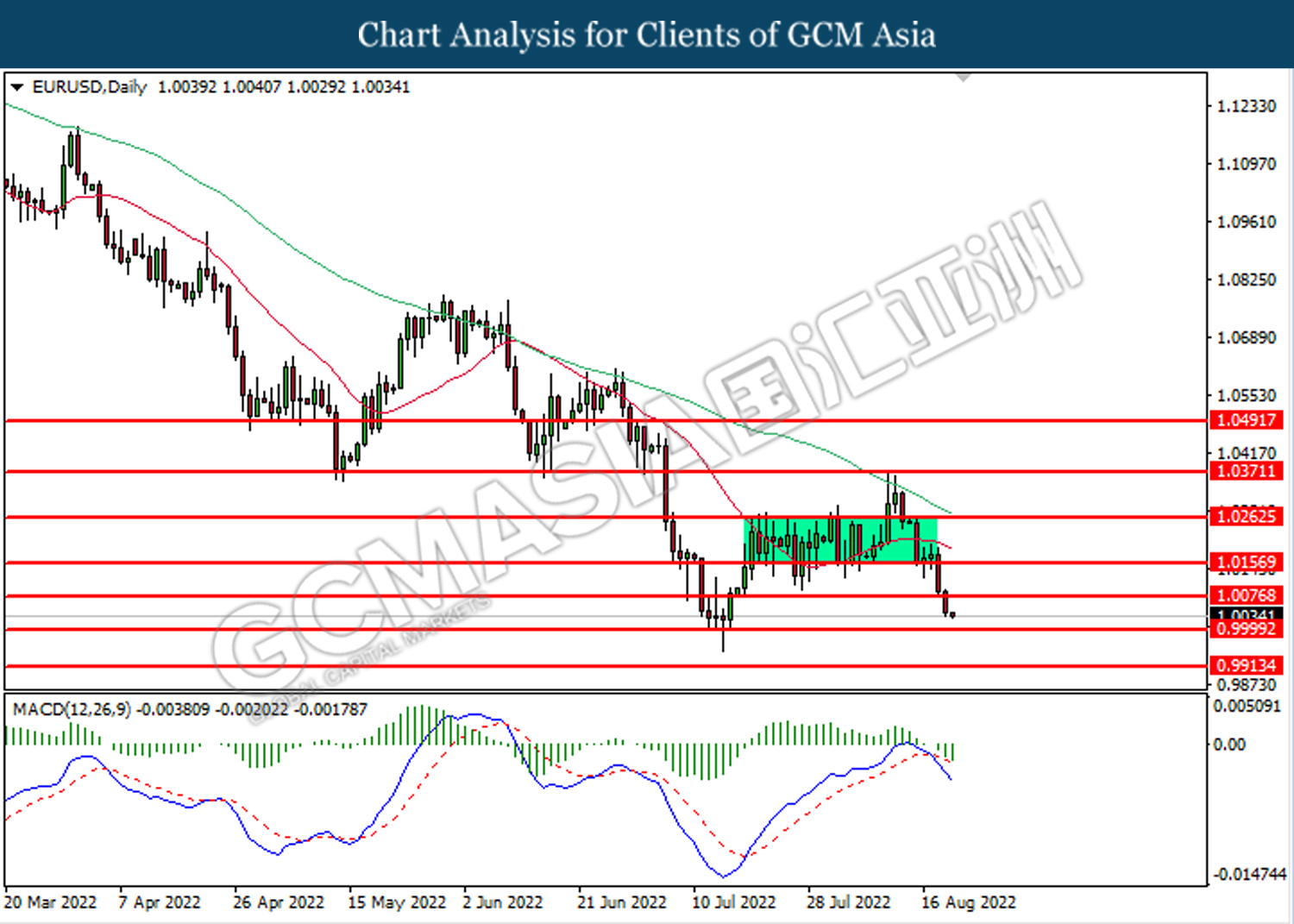

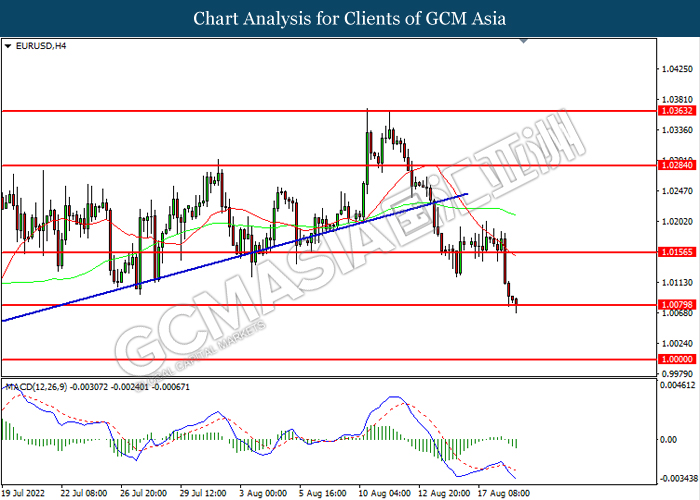

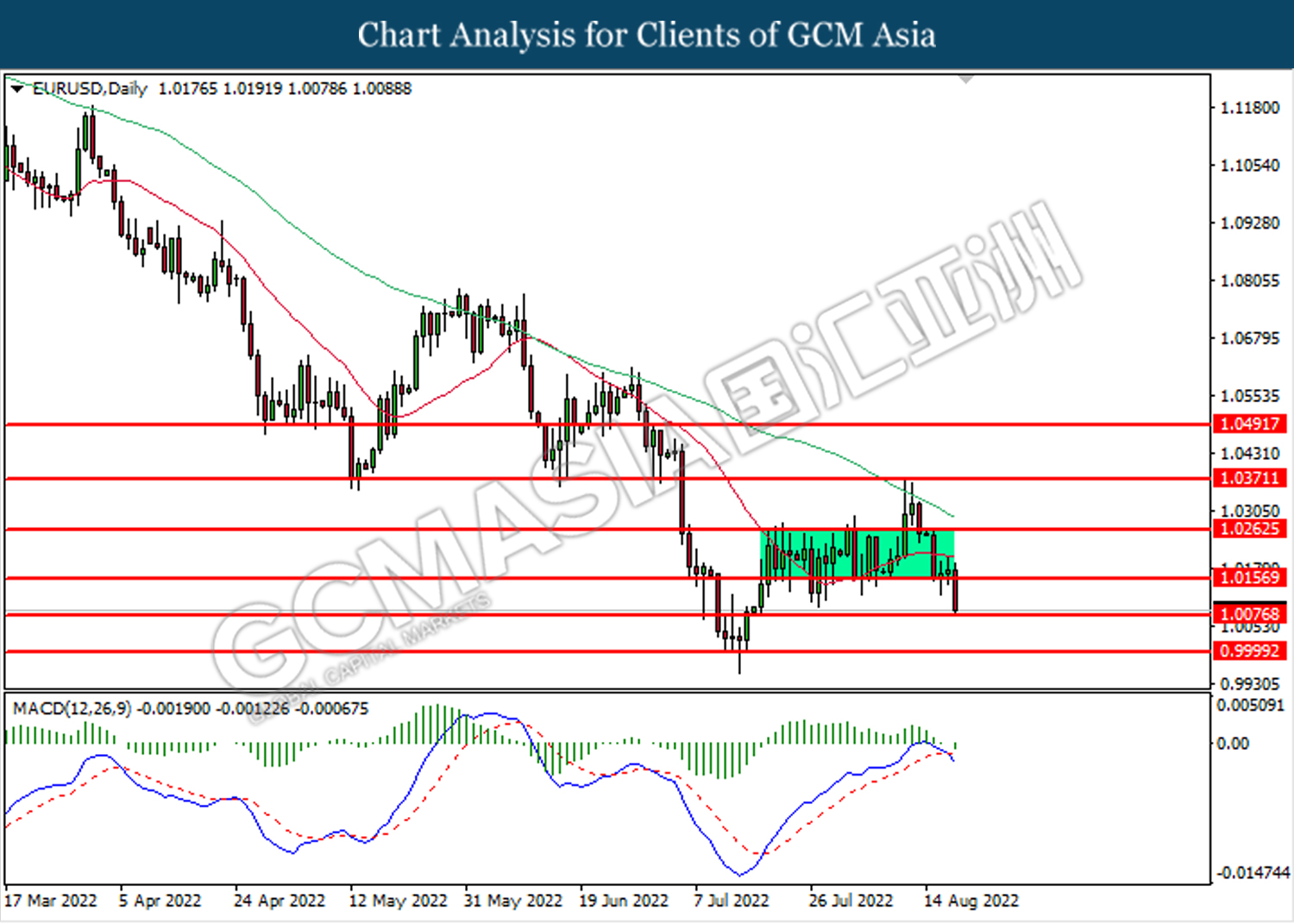

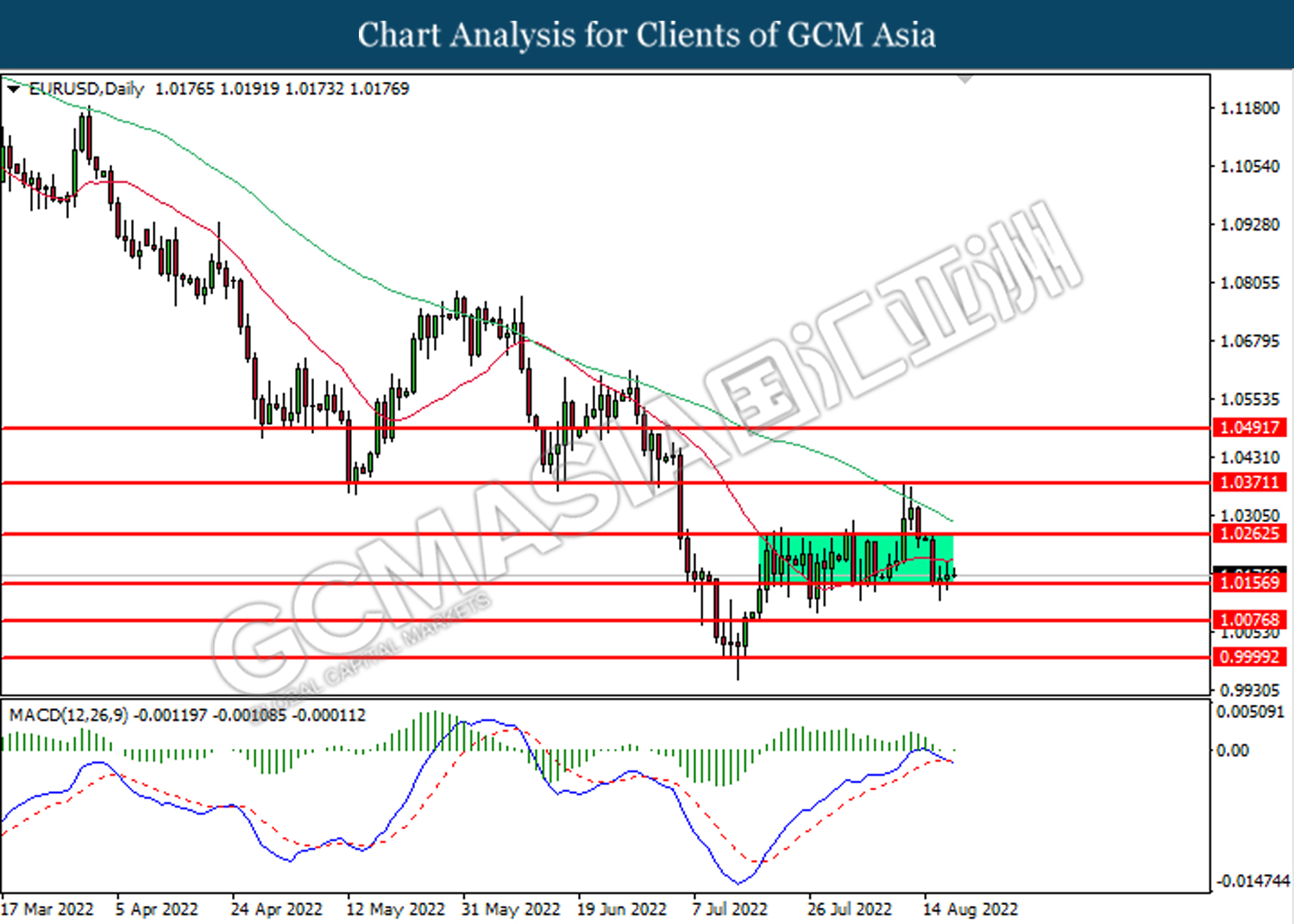

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

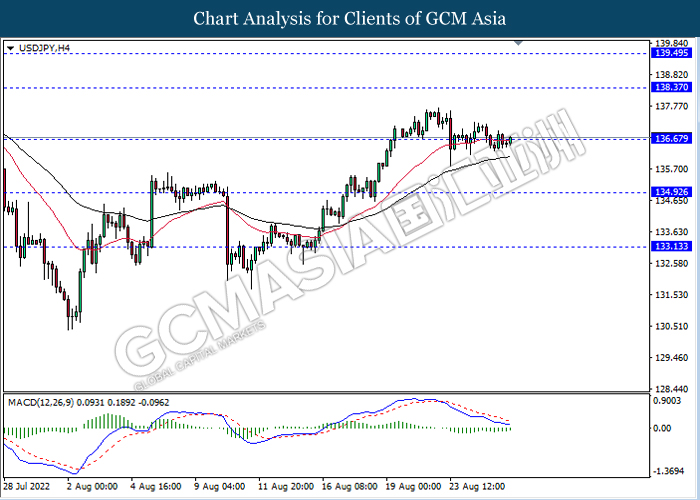

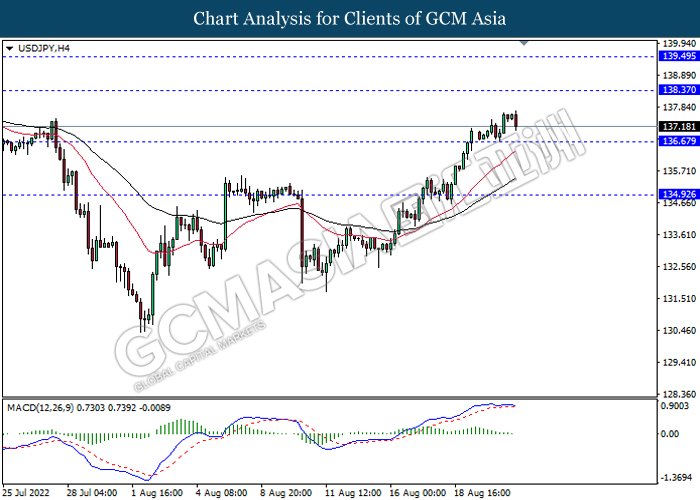

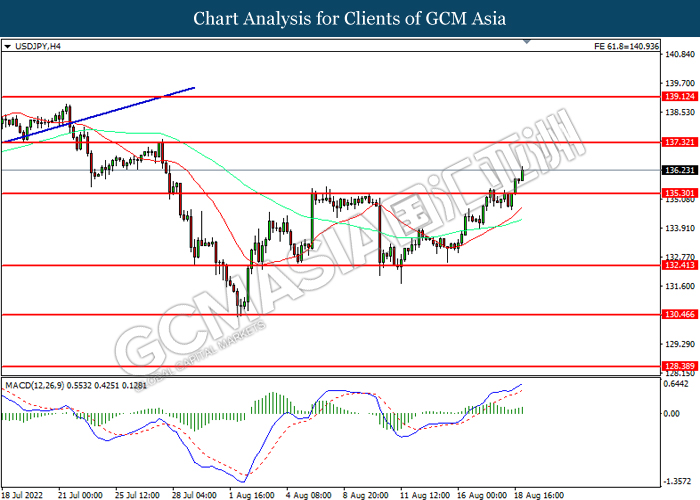

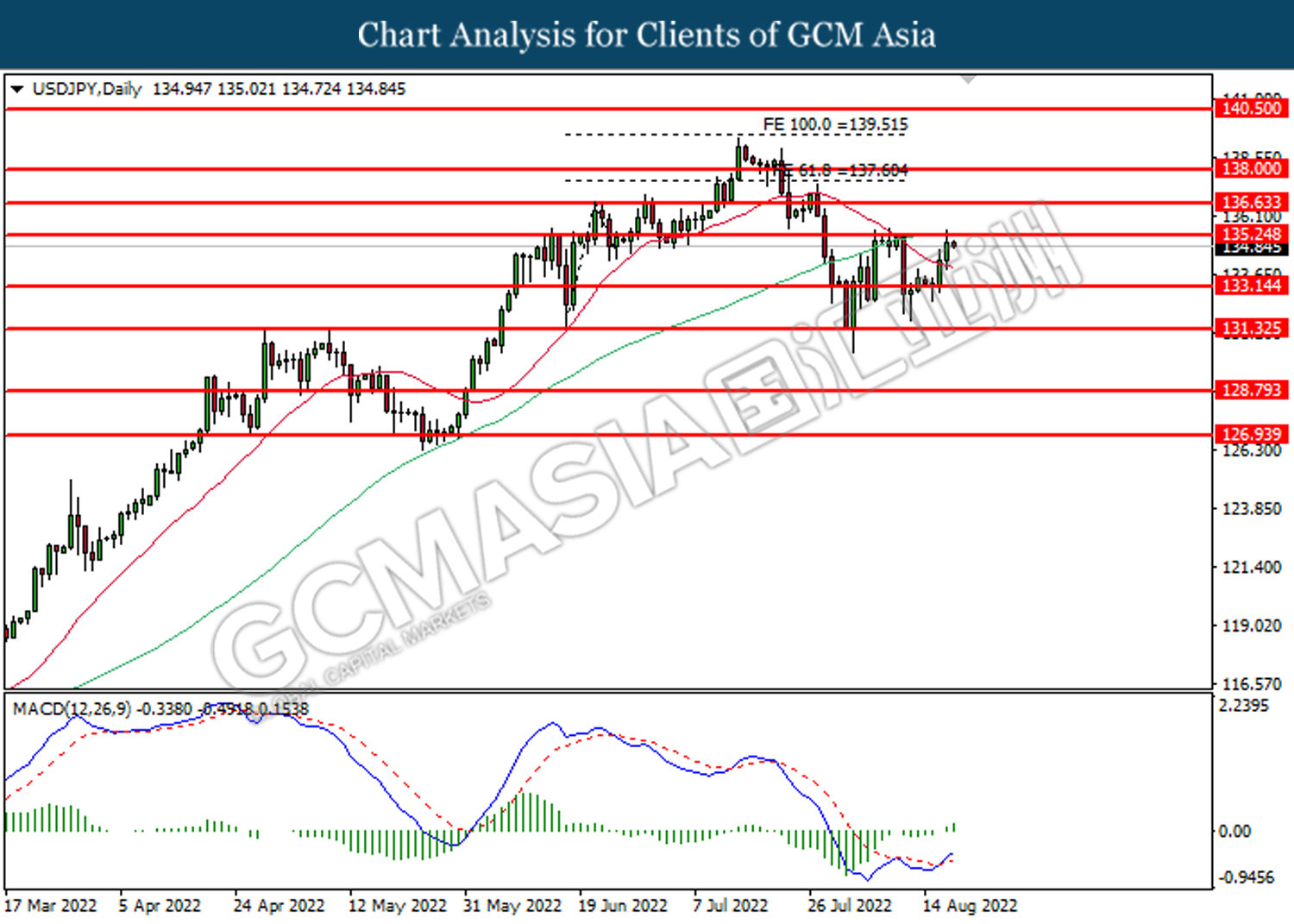

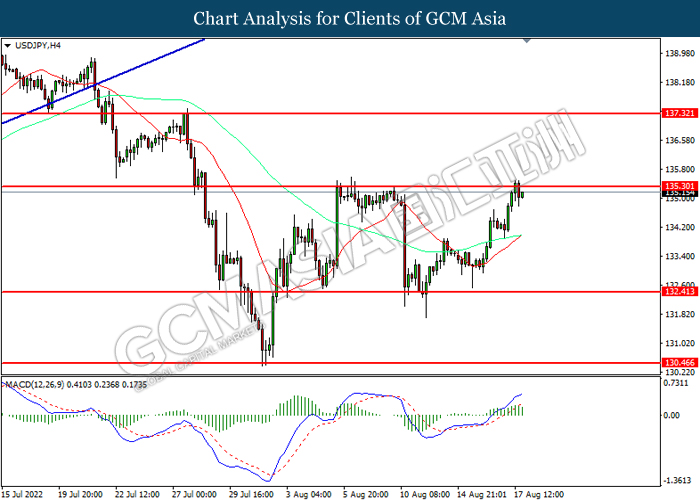

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 138.00 MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

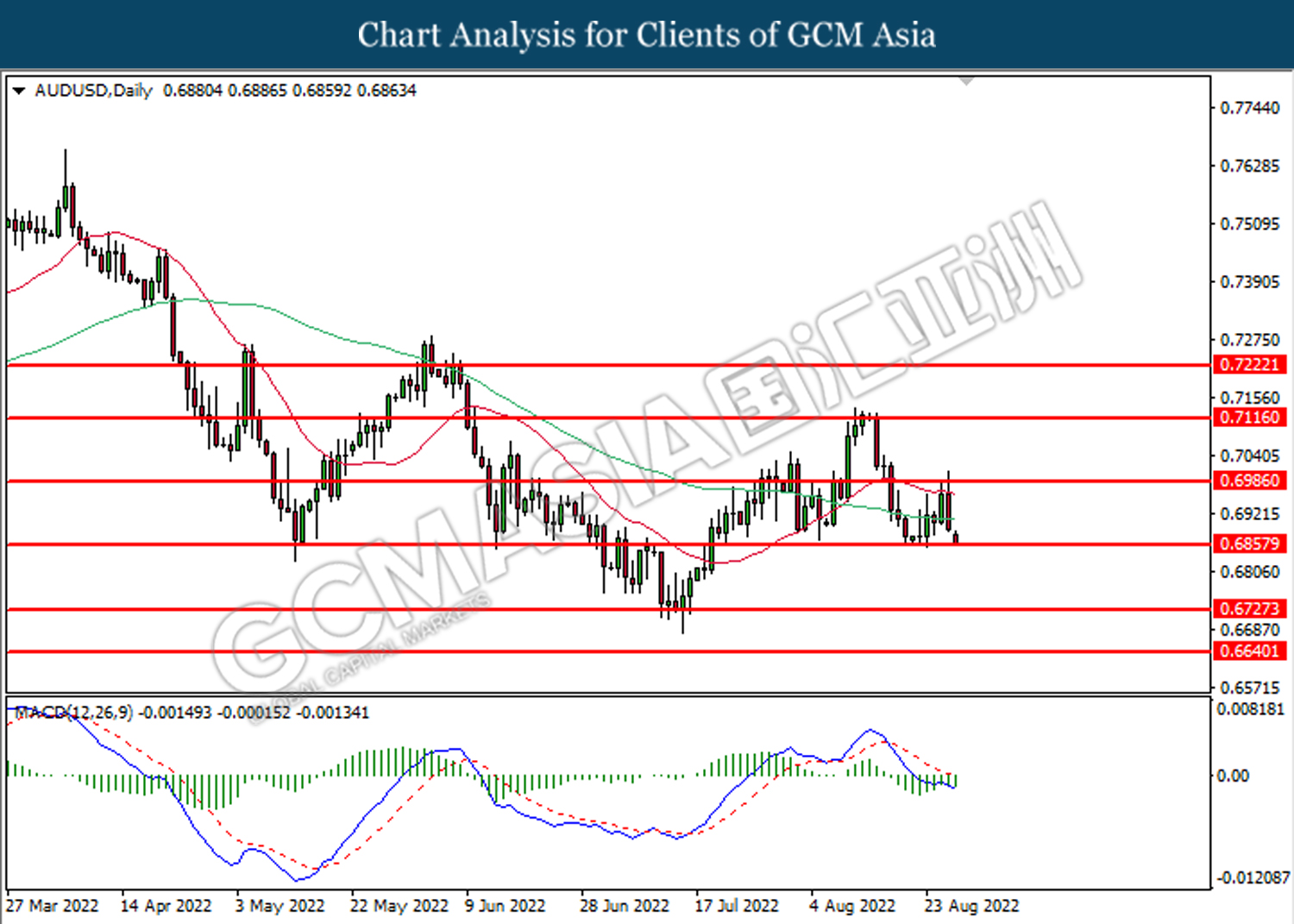

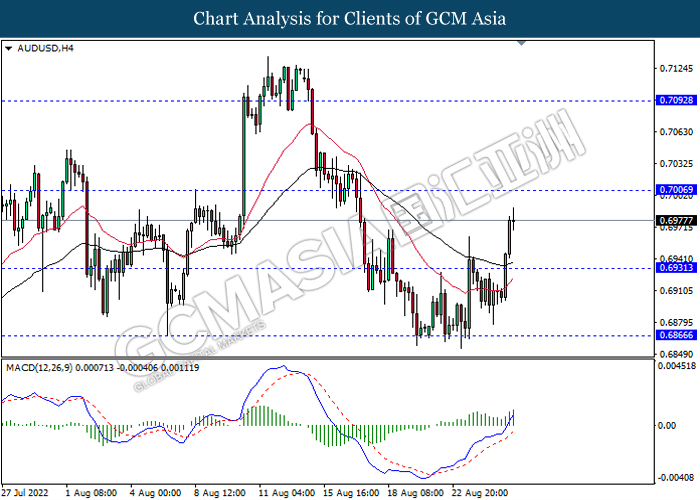

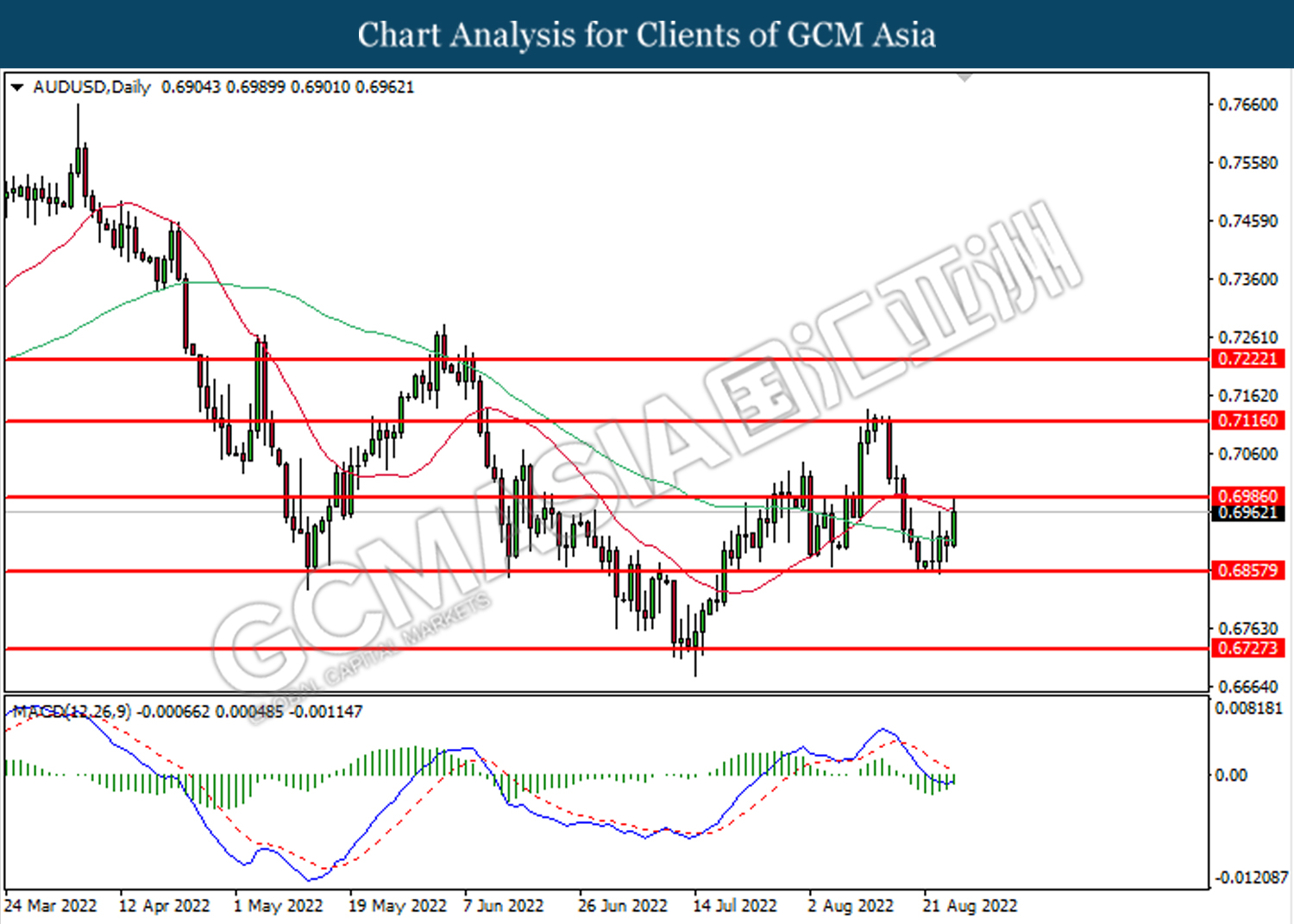

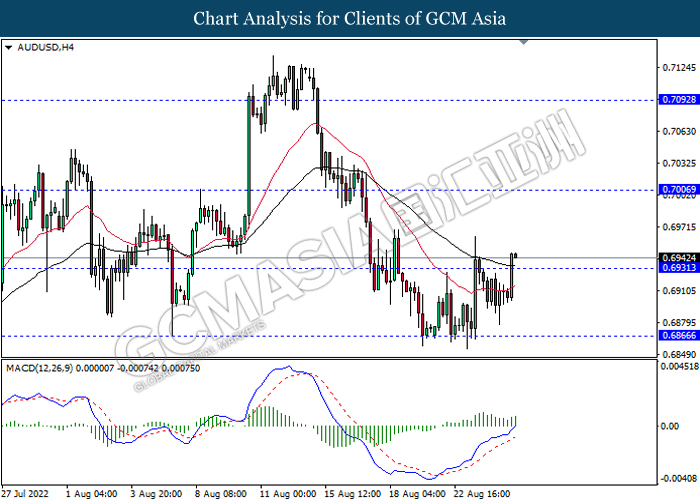

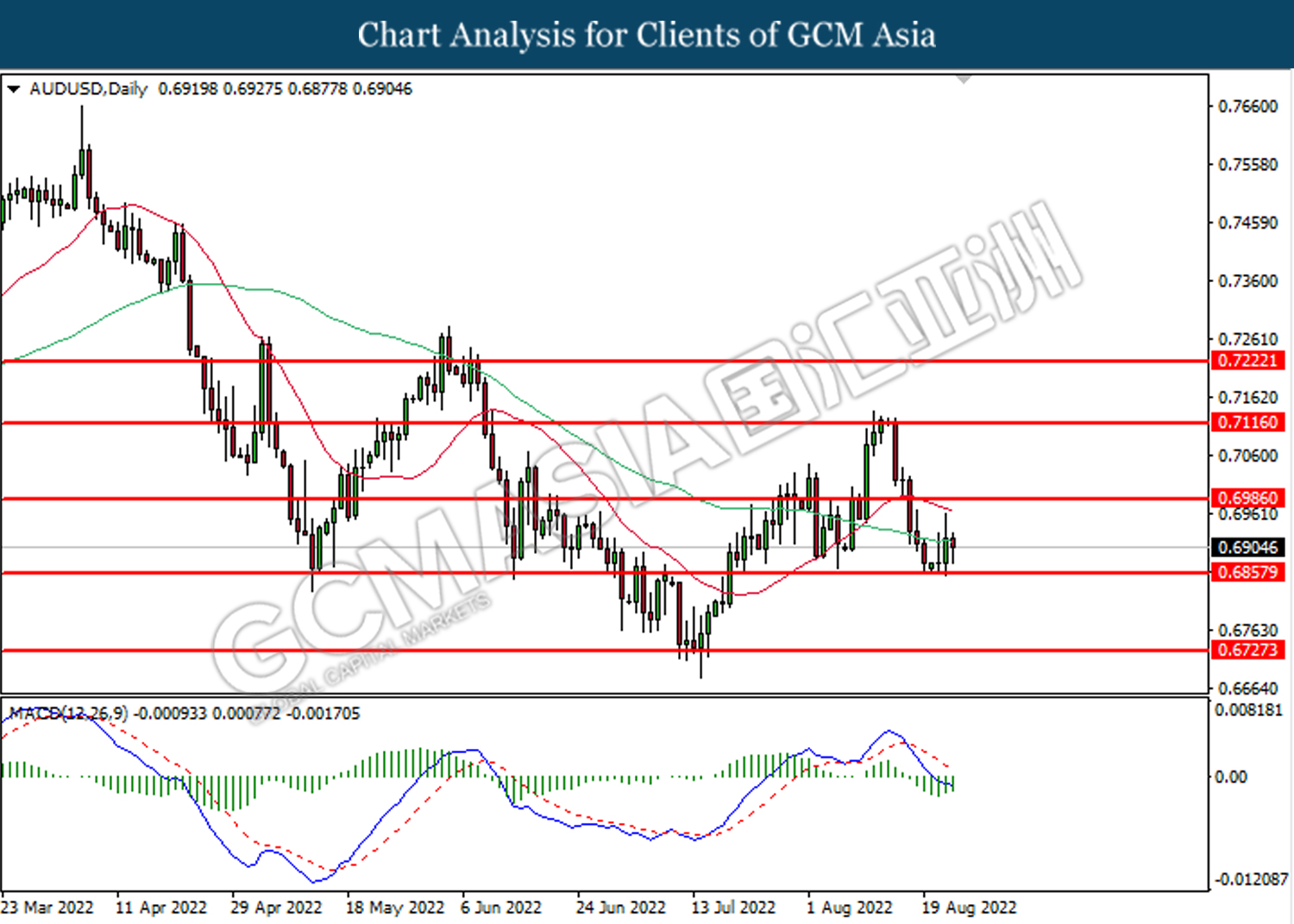

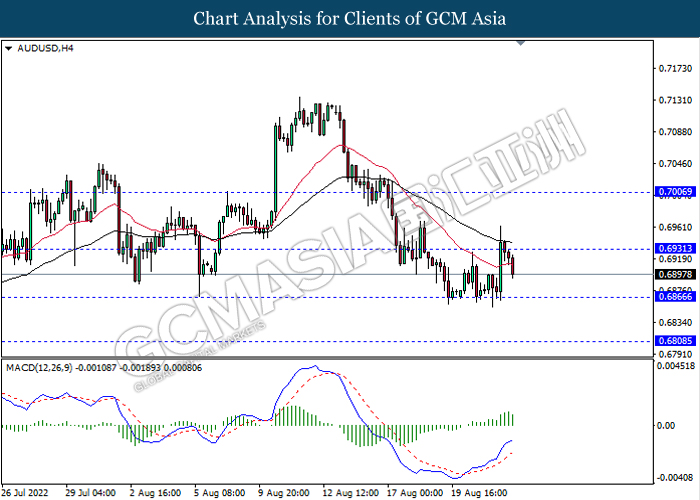

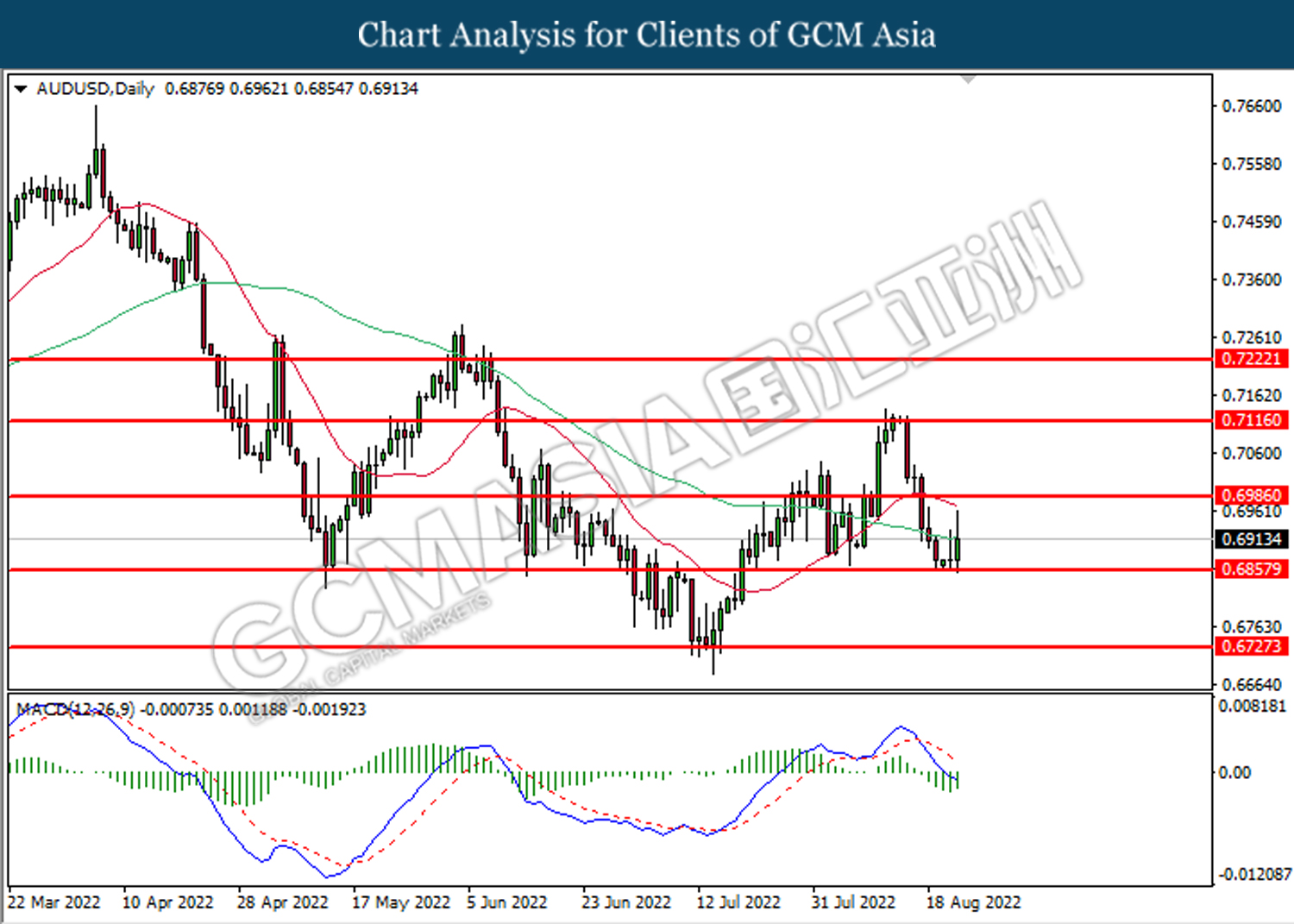

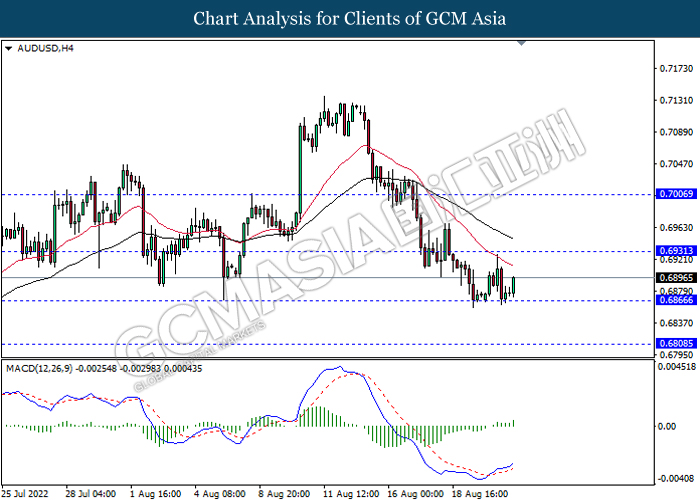

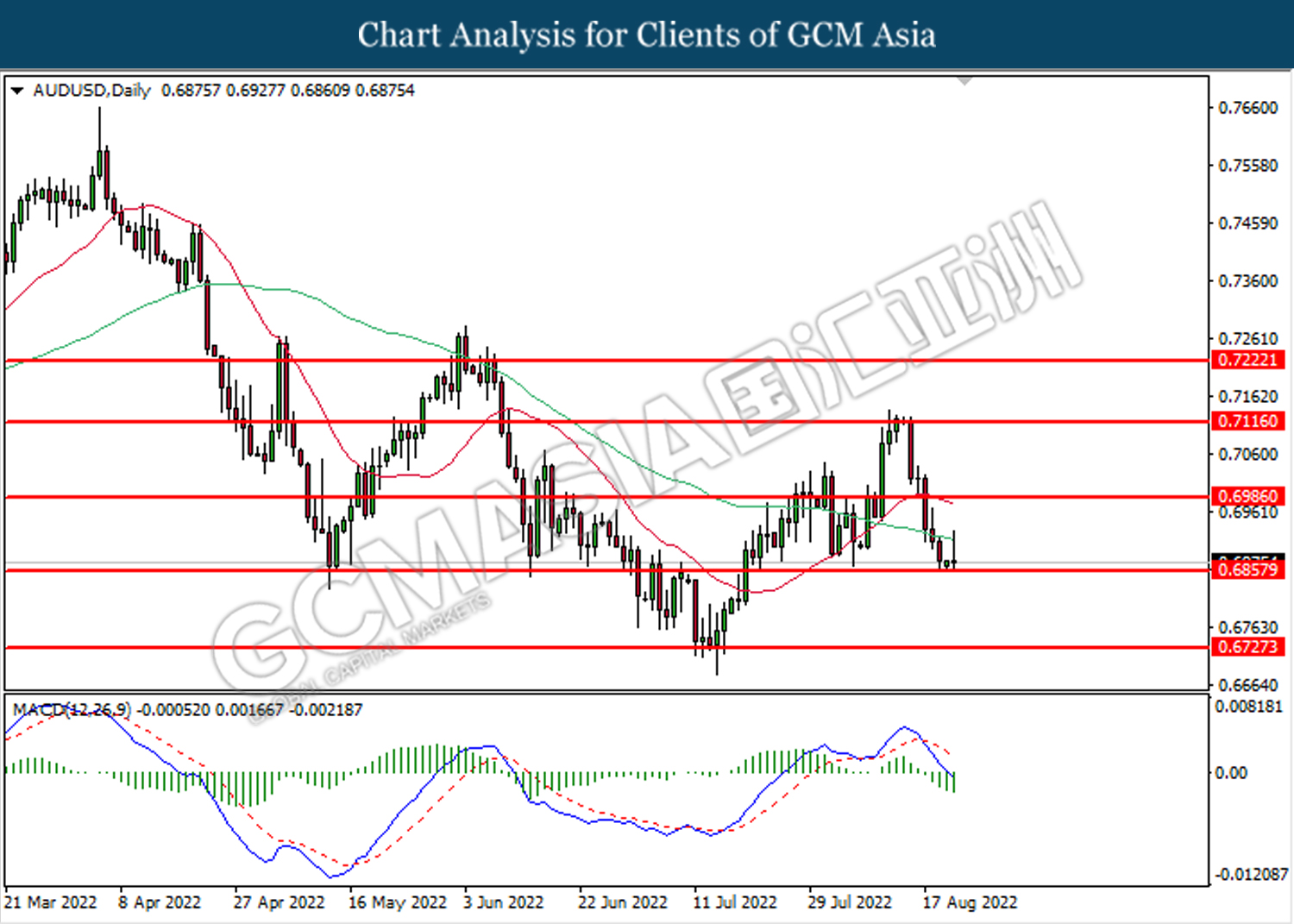

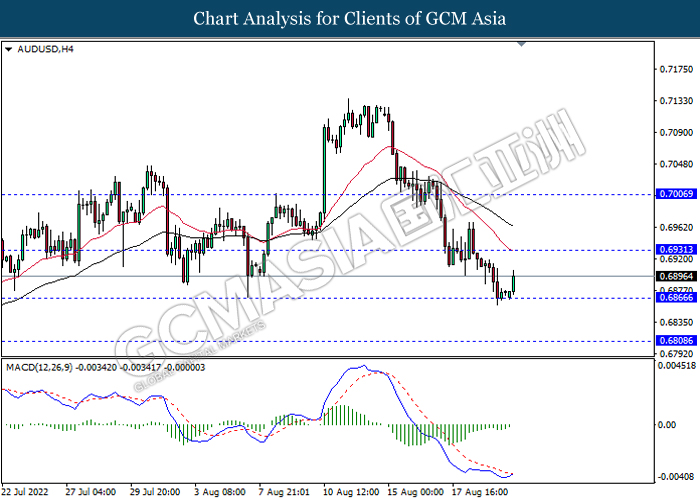

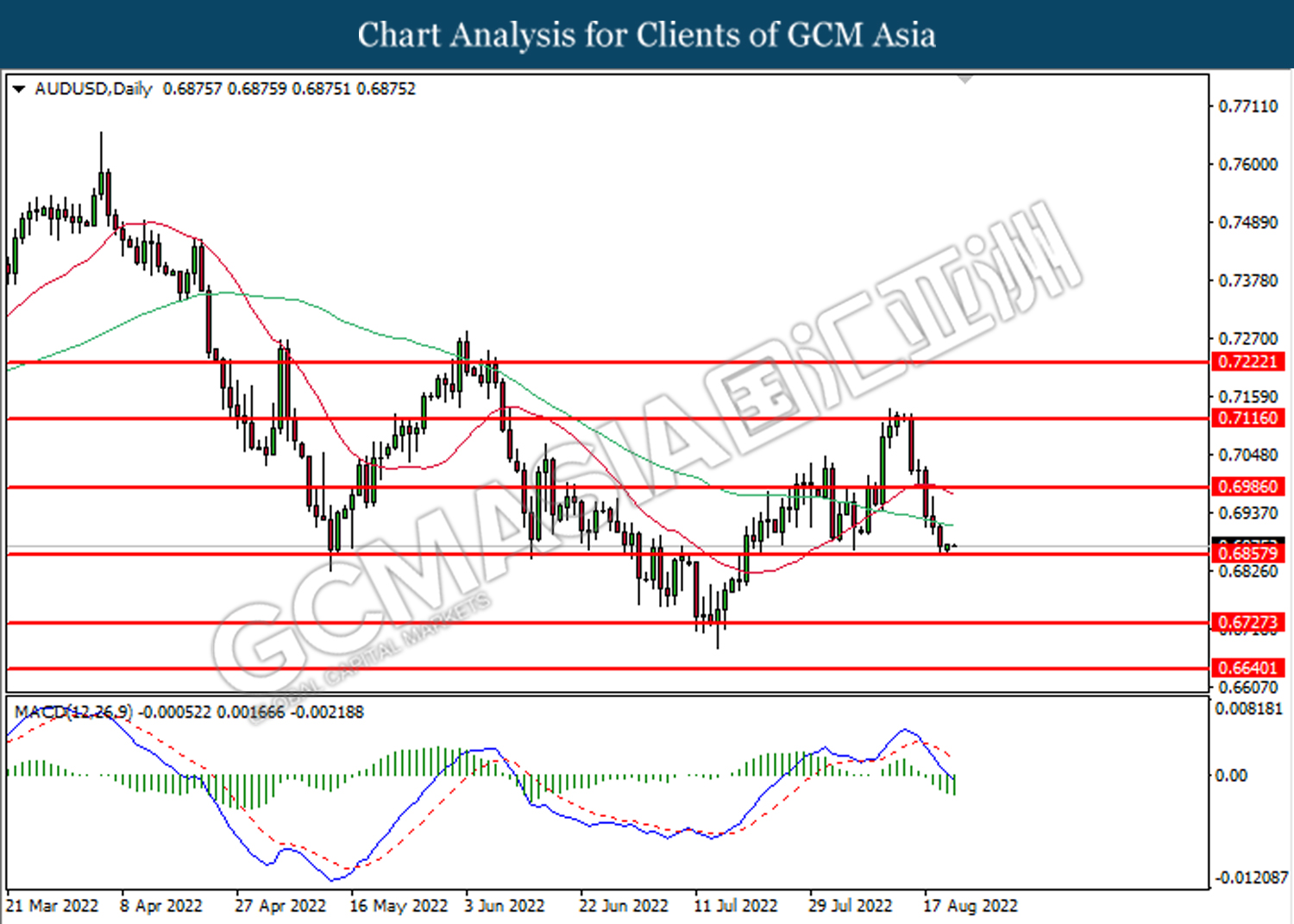

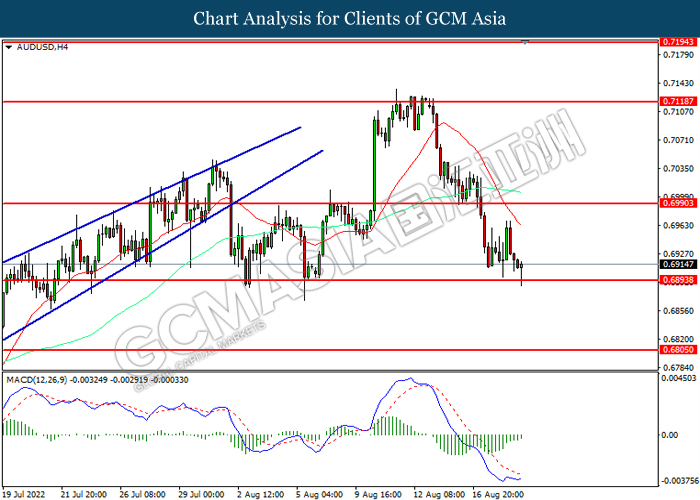

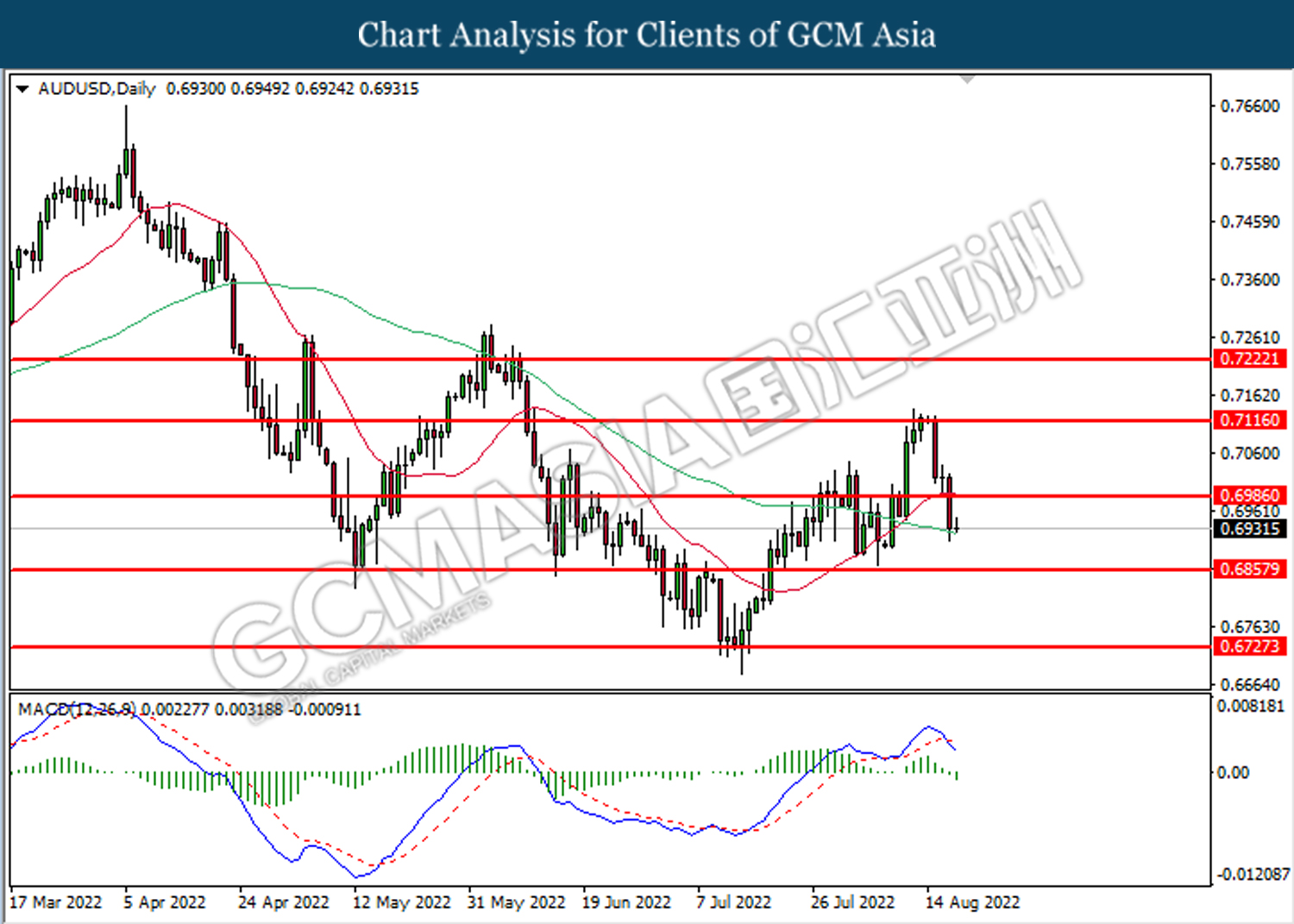

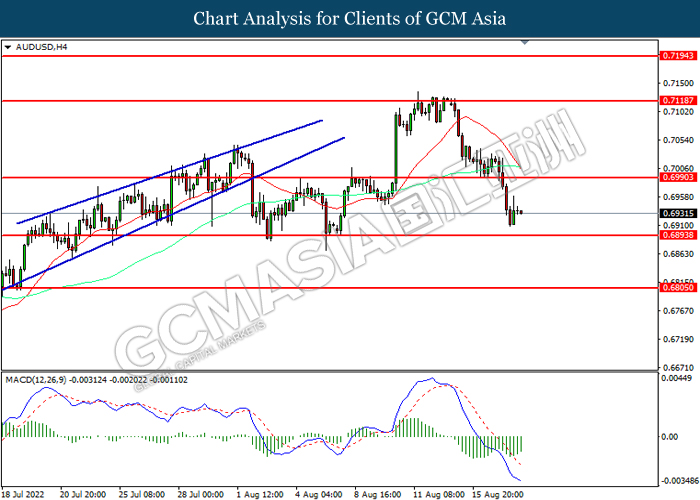

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

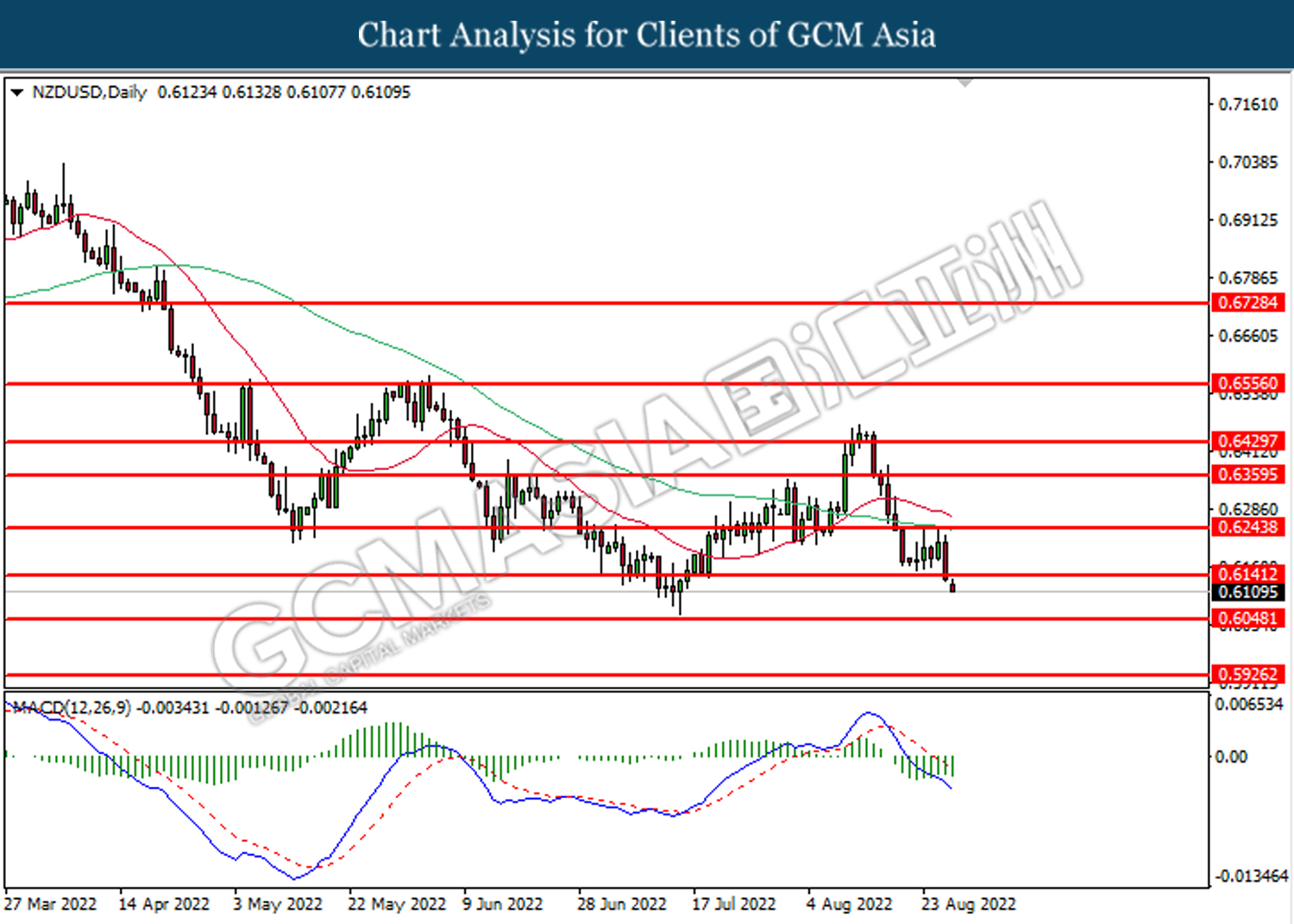

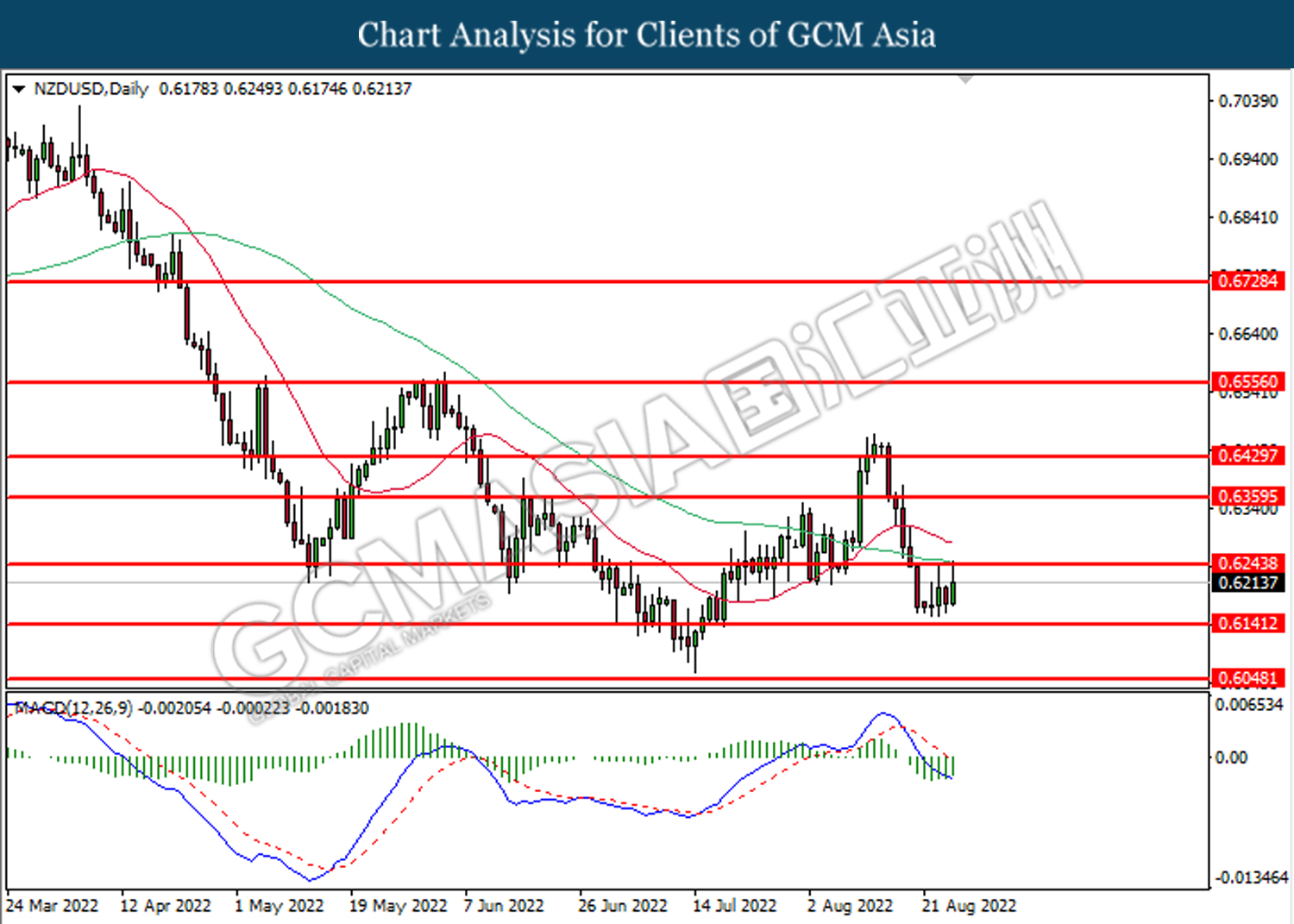

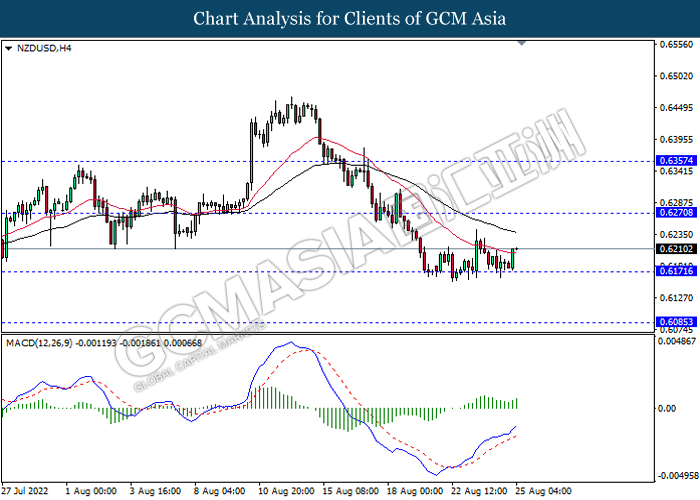

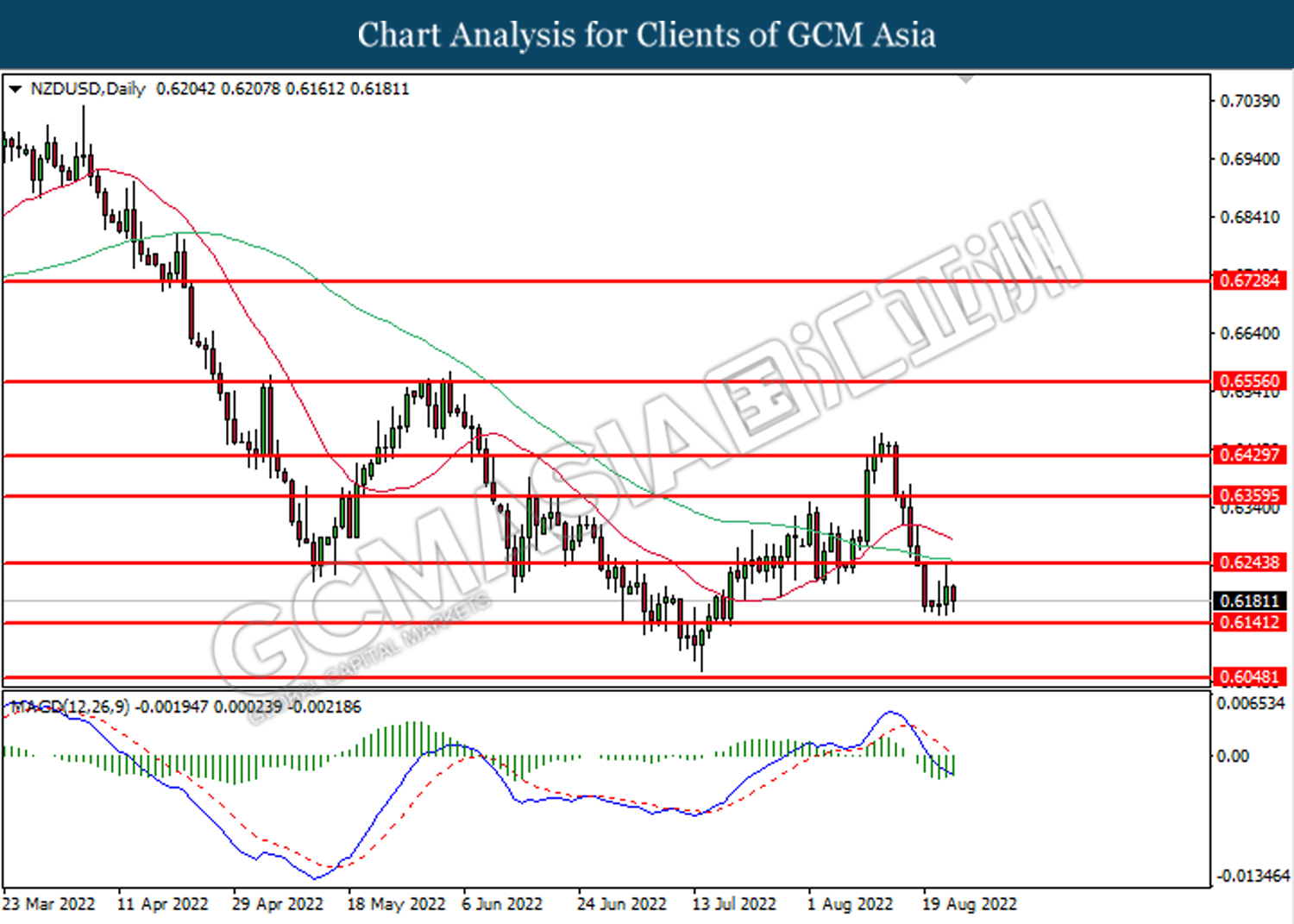

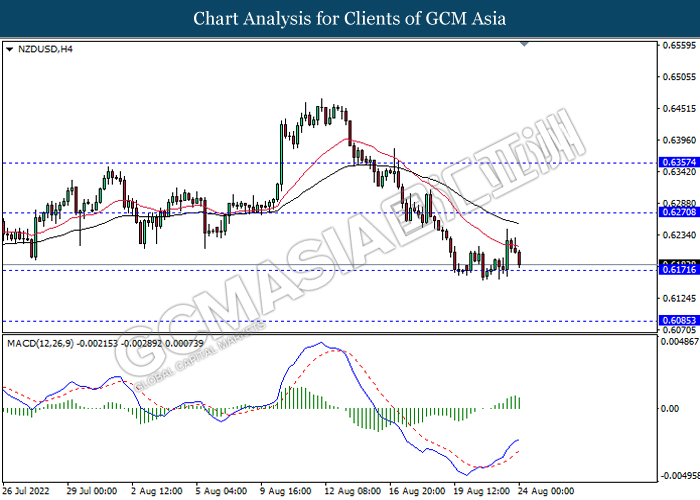

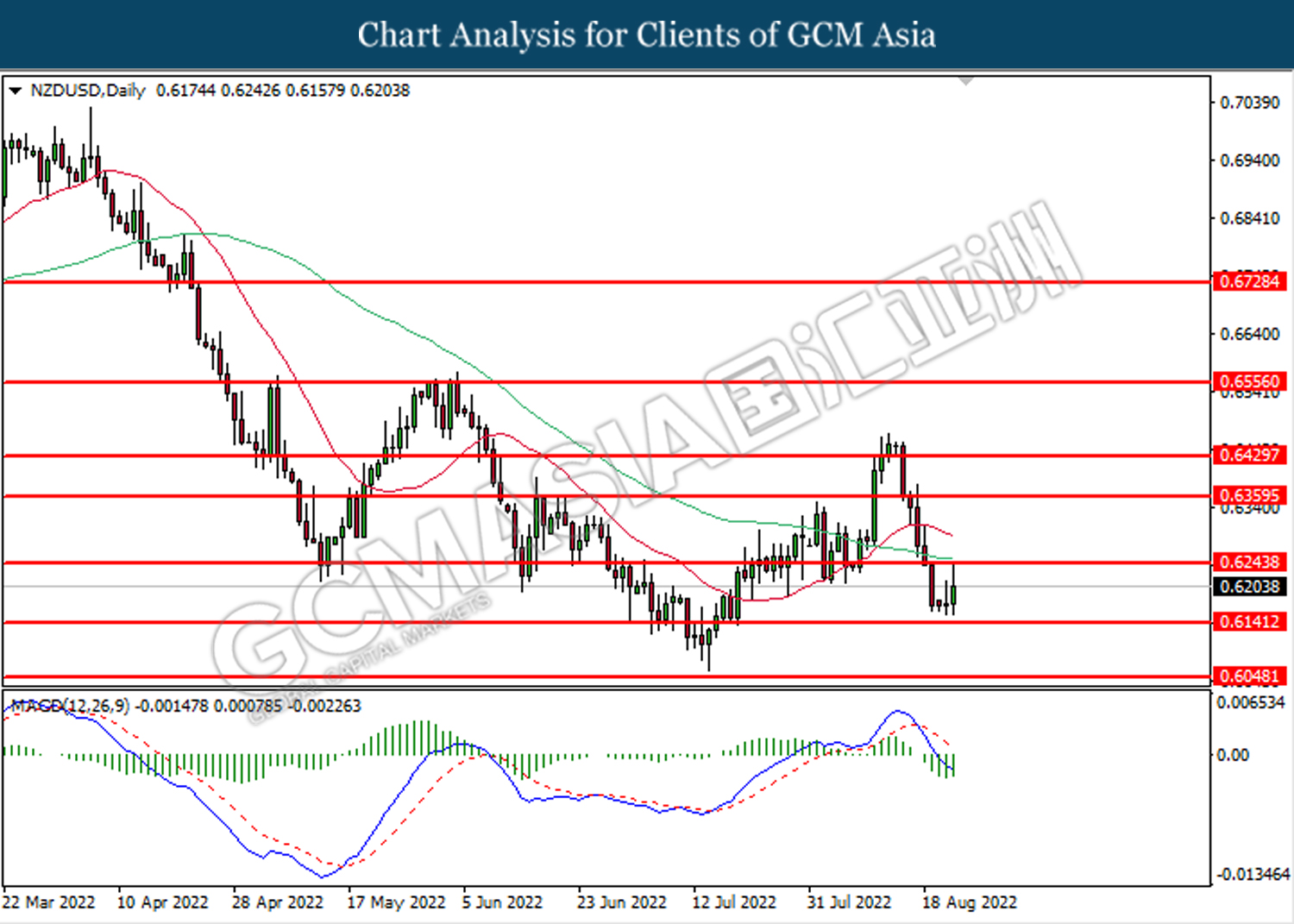

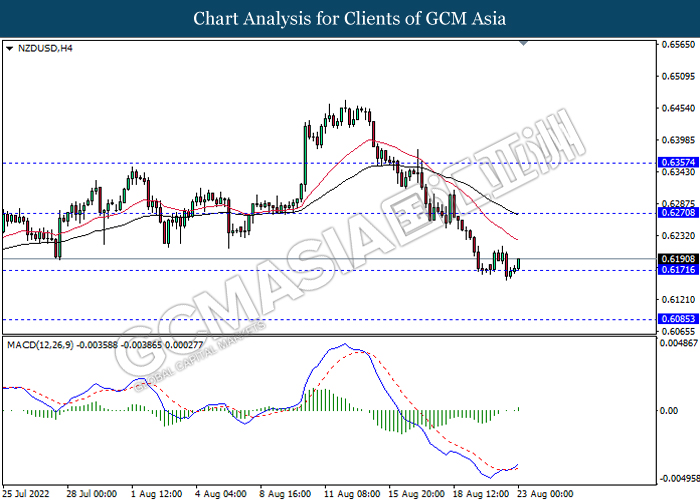

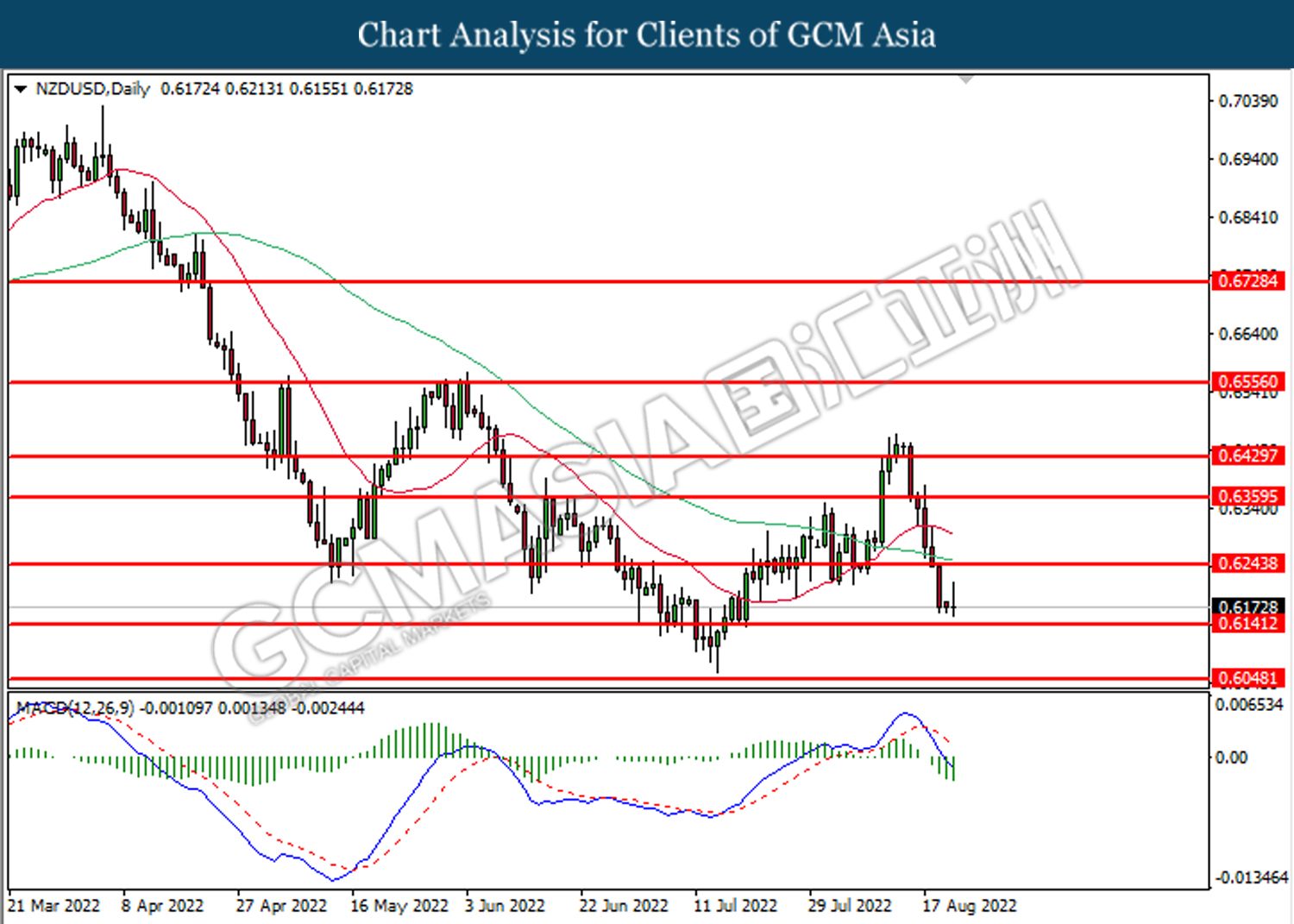

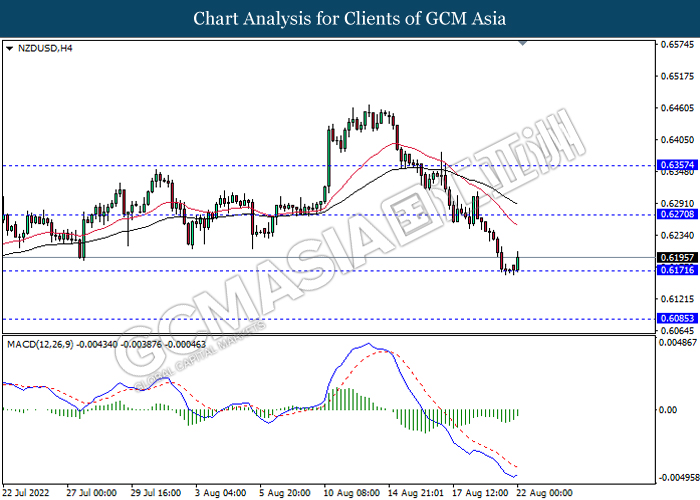

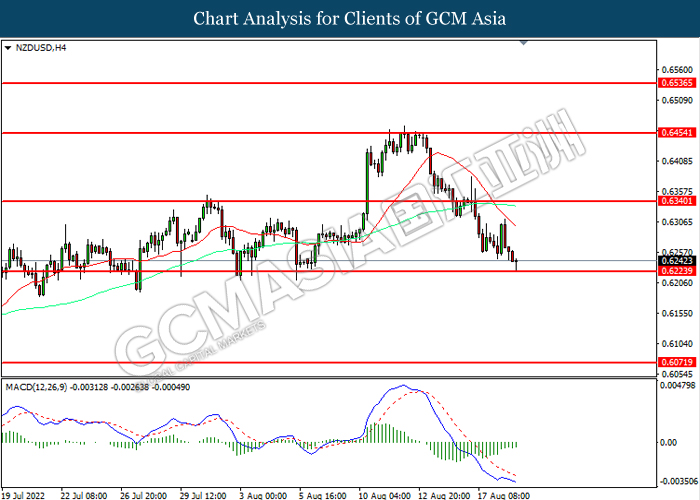

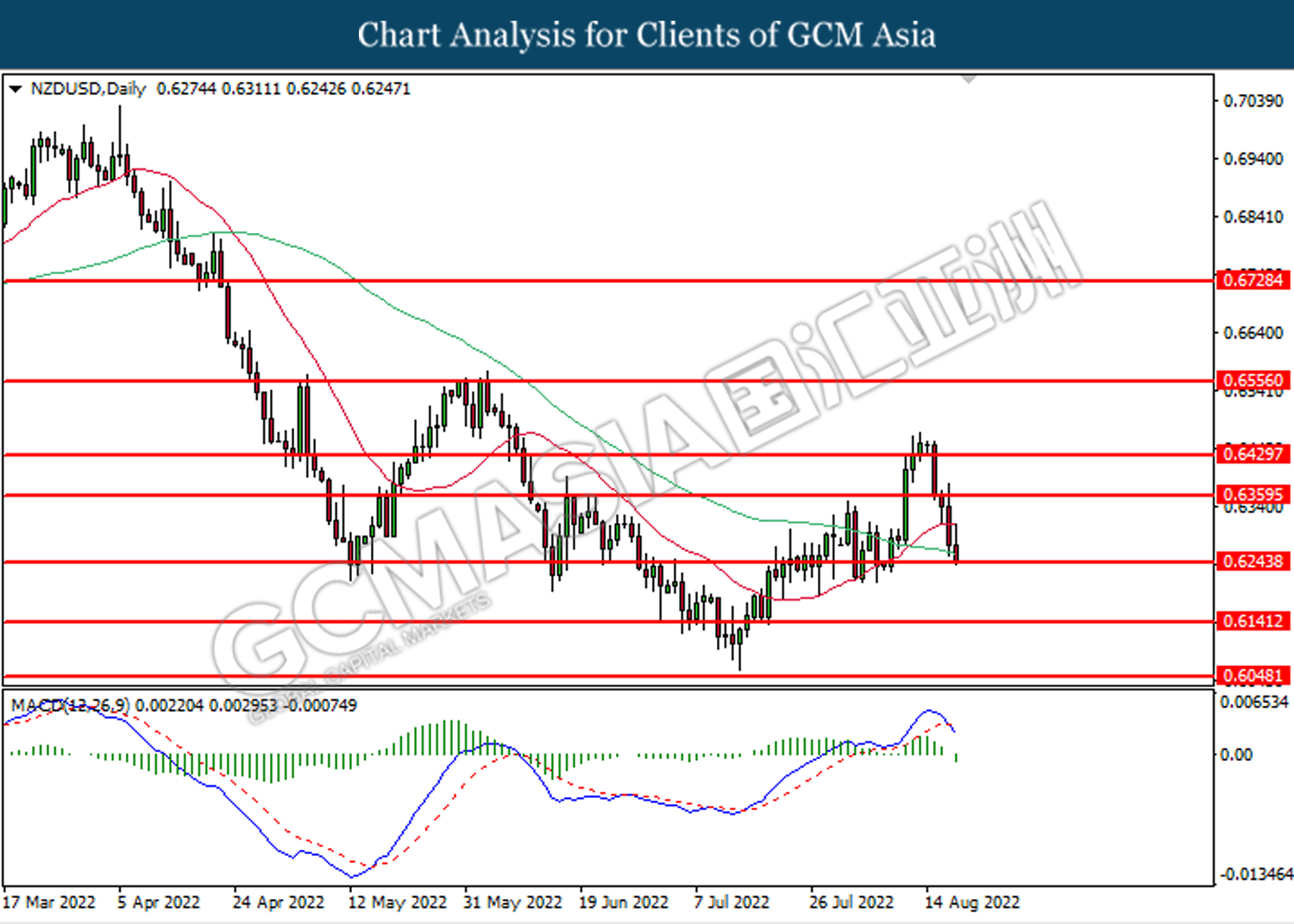

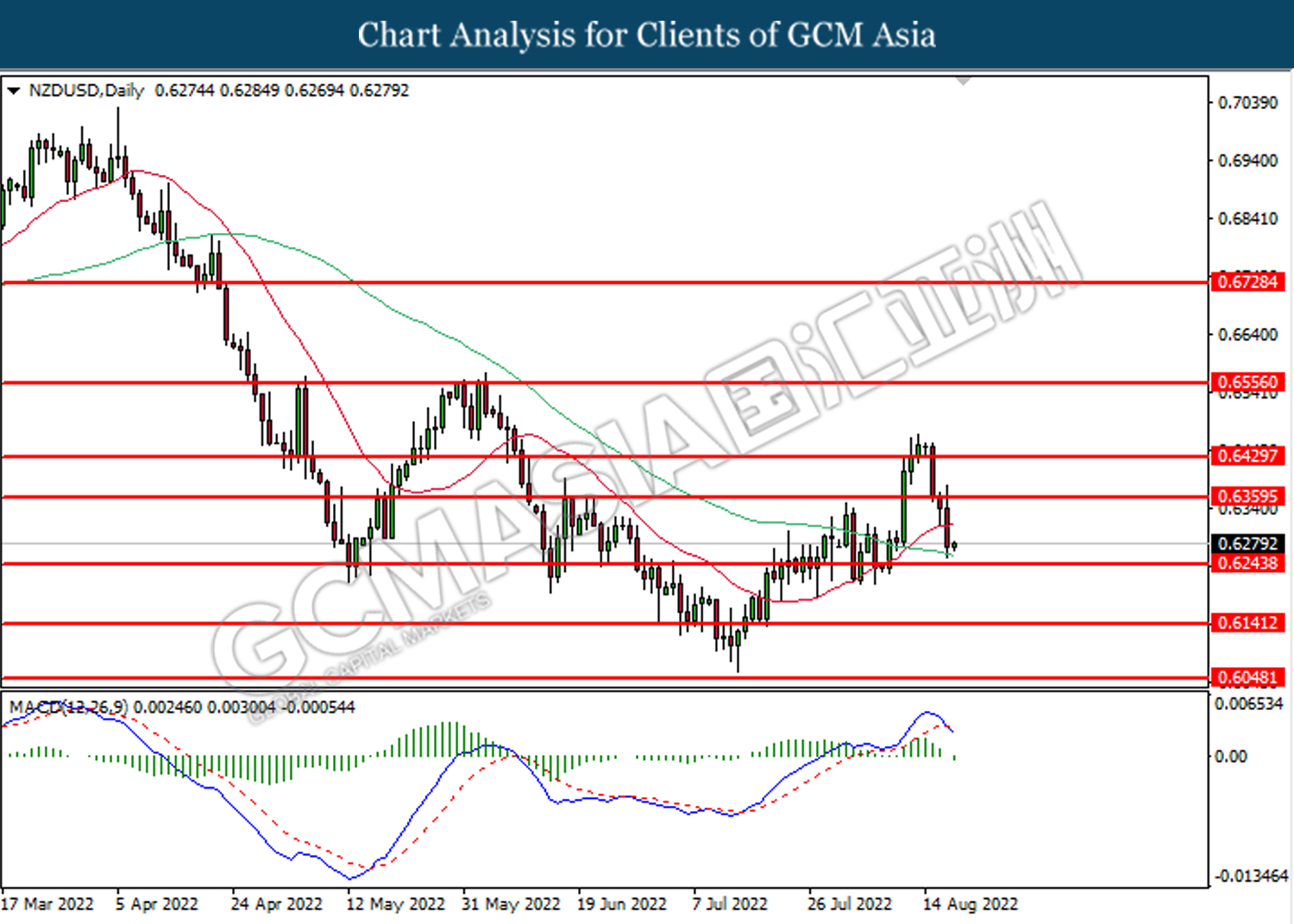

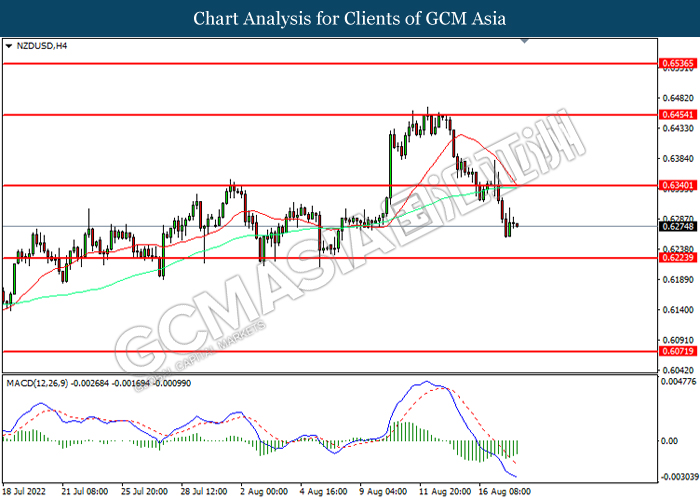

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

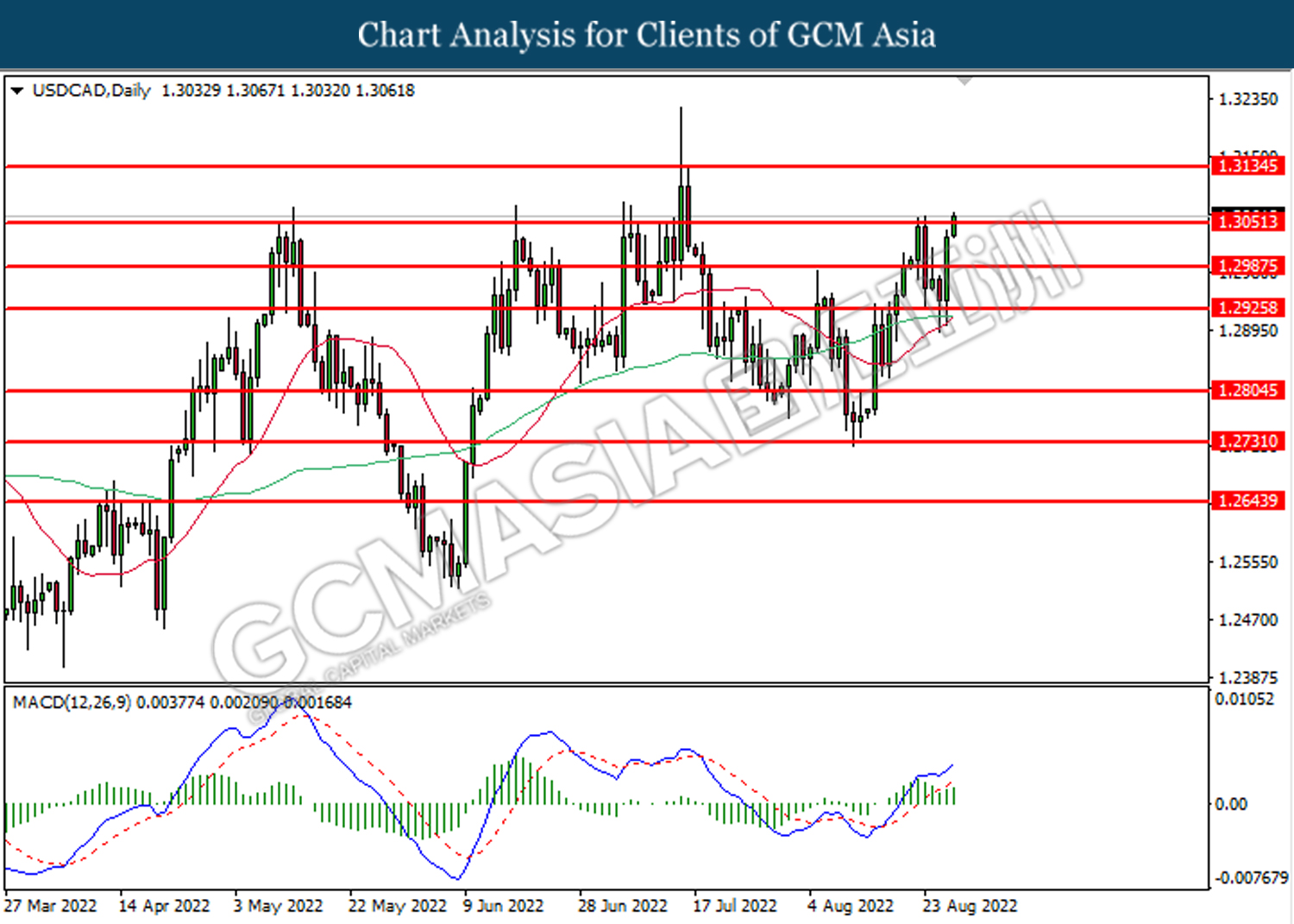

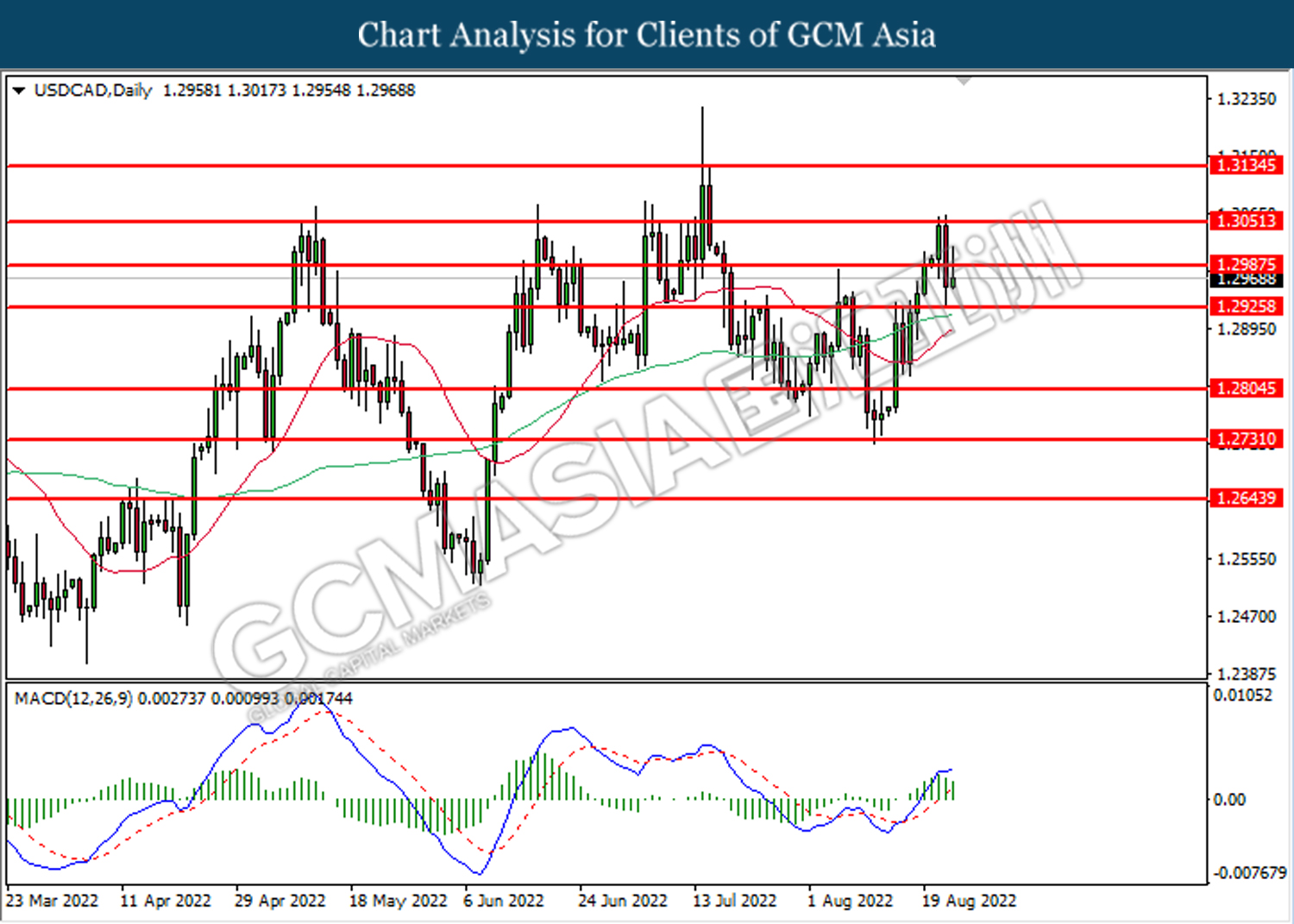

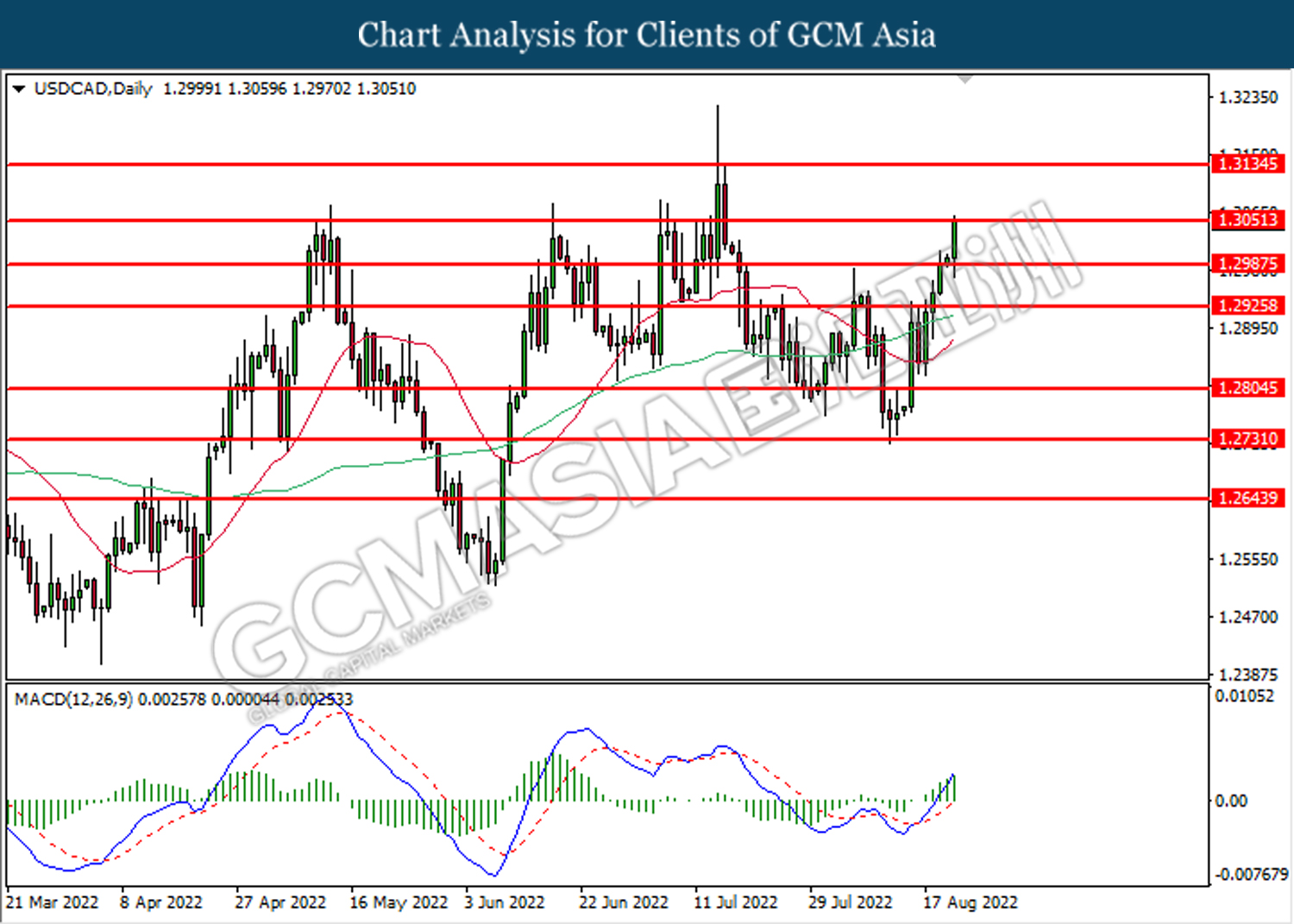

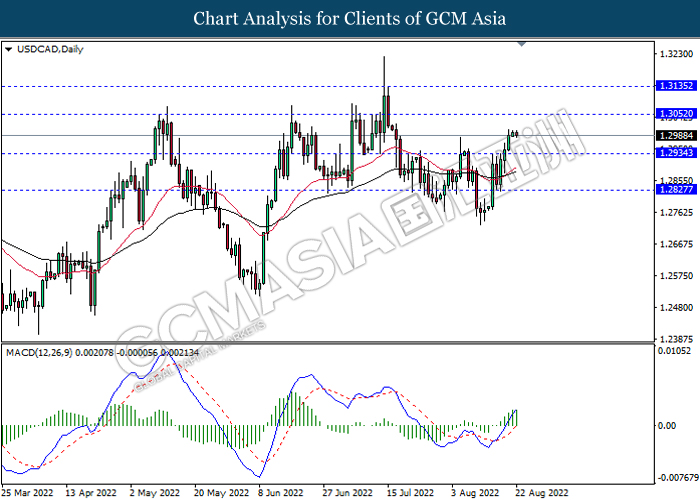

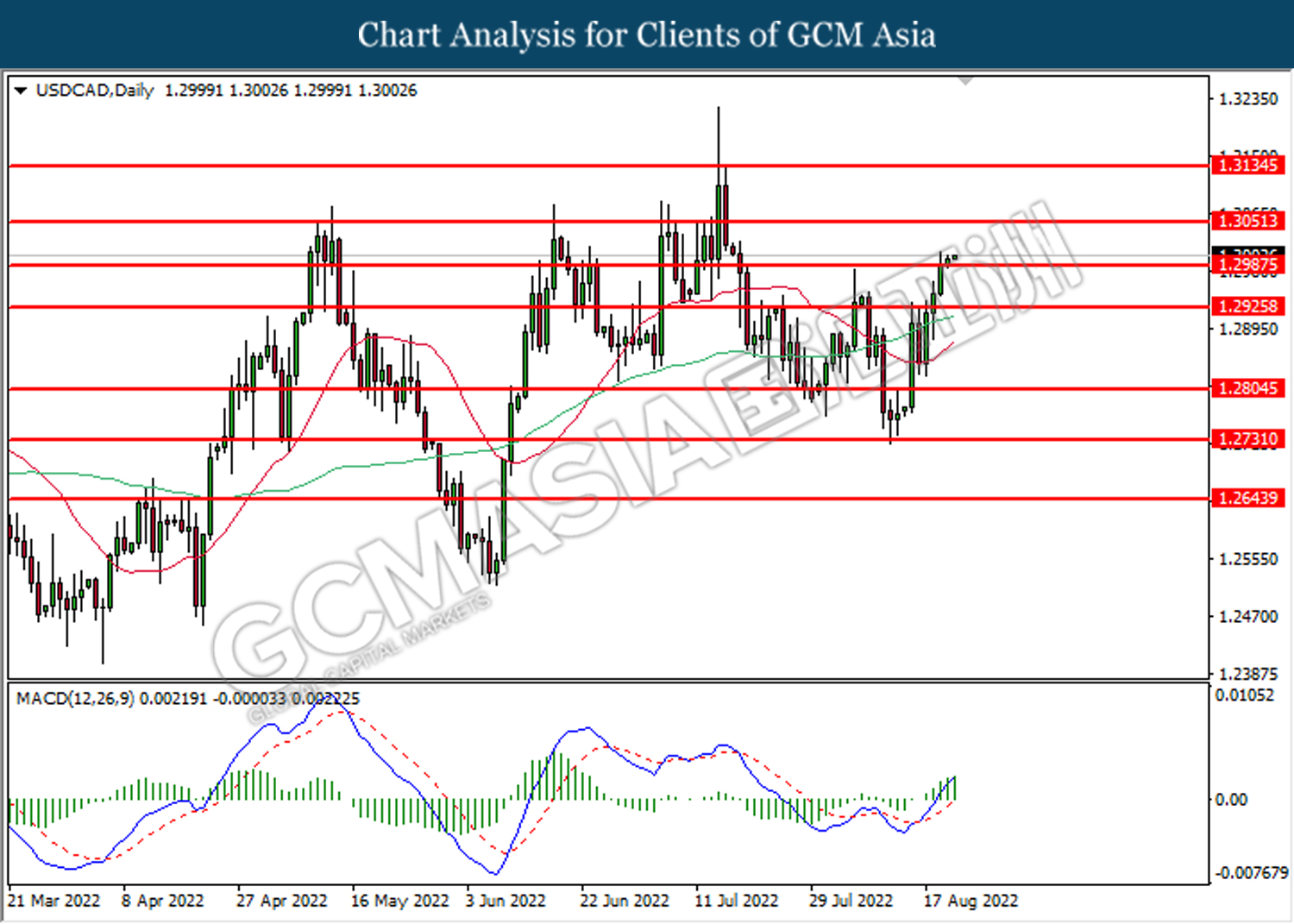

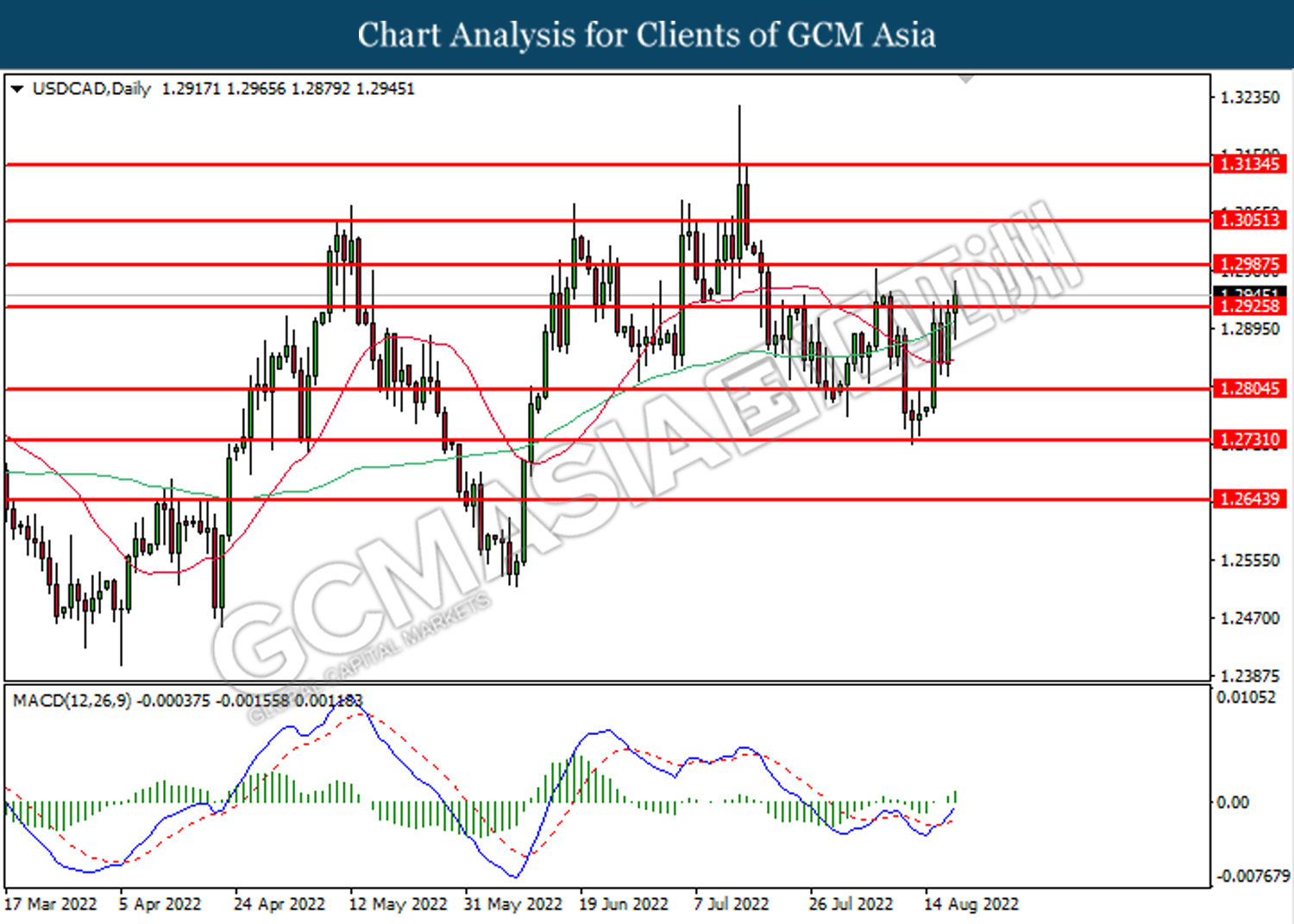

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3050. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

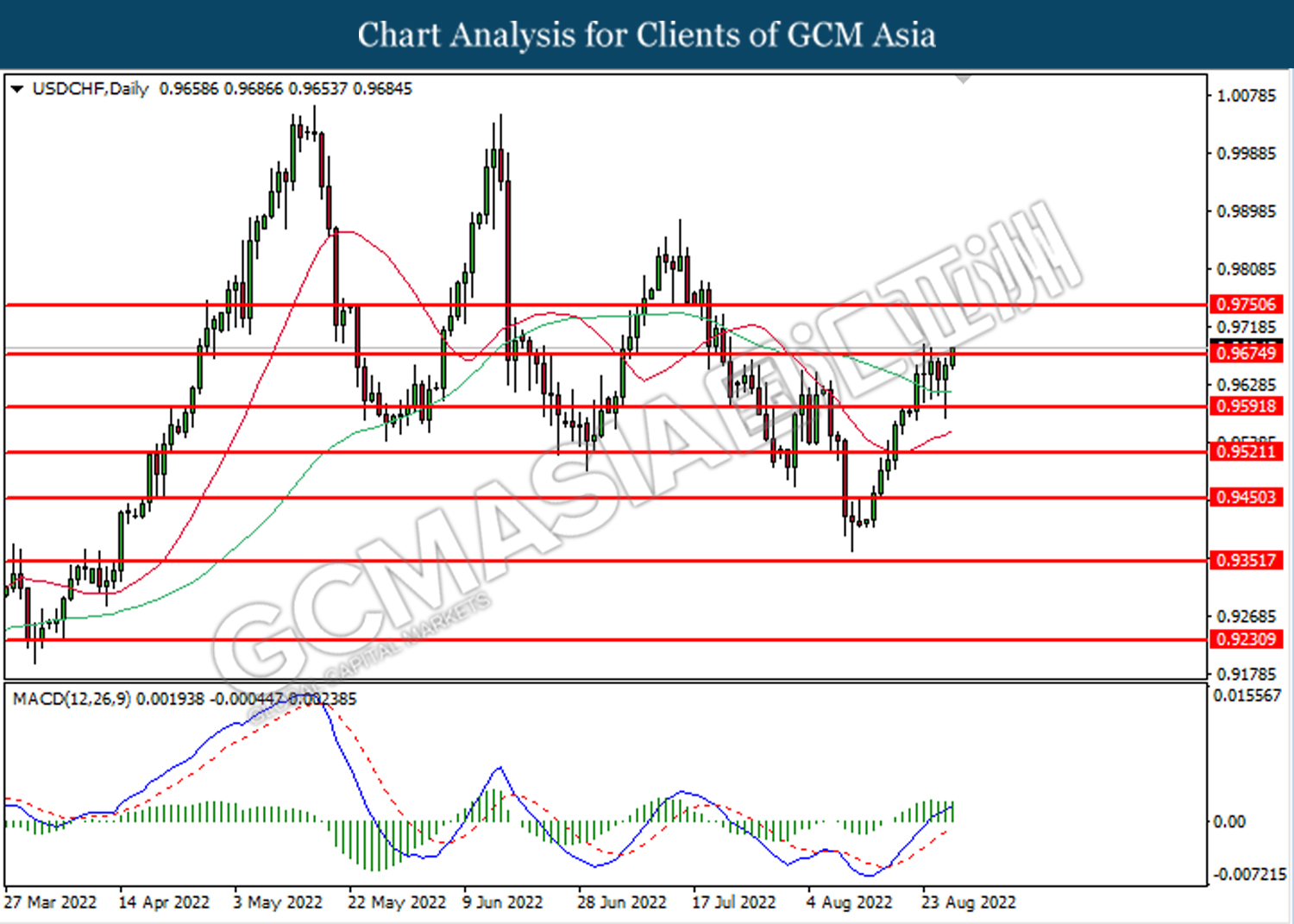

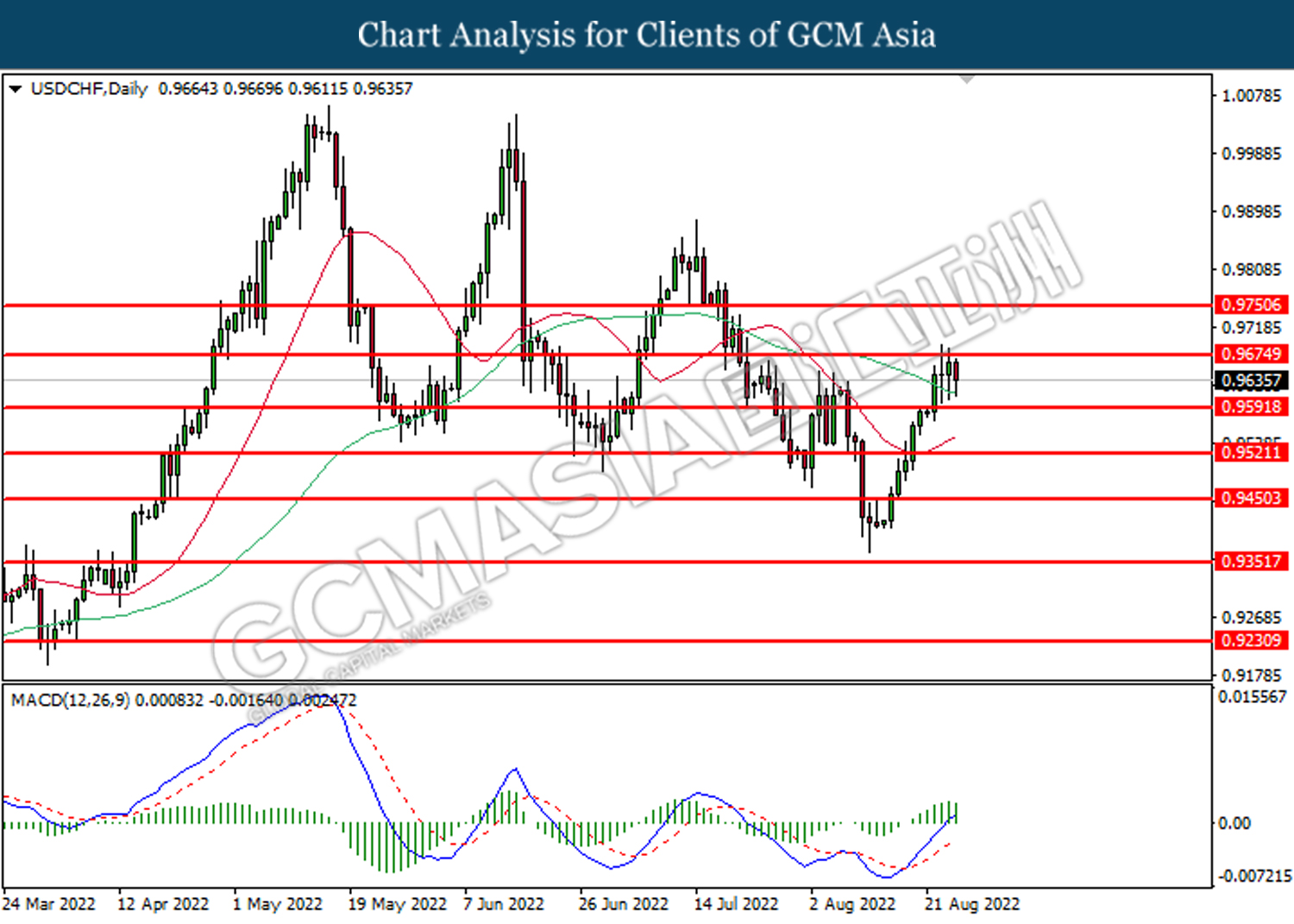

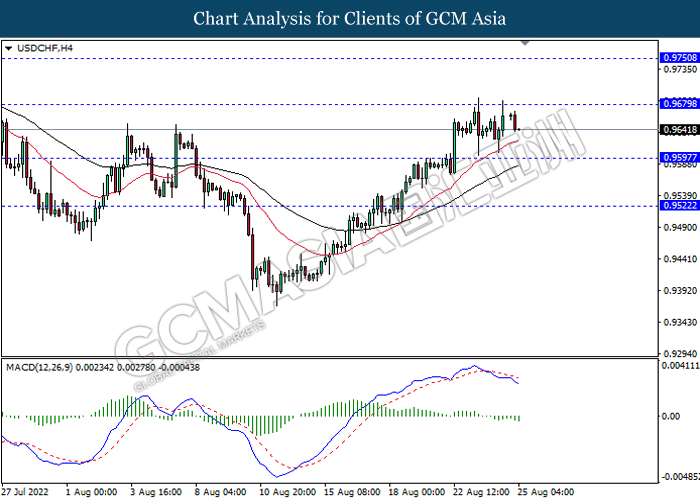

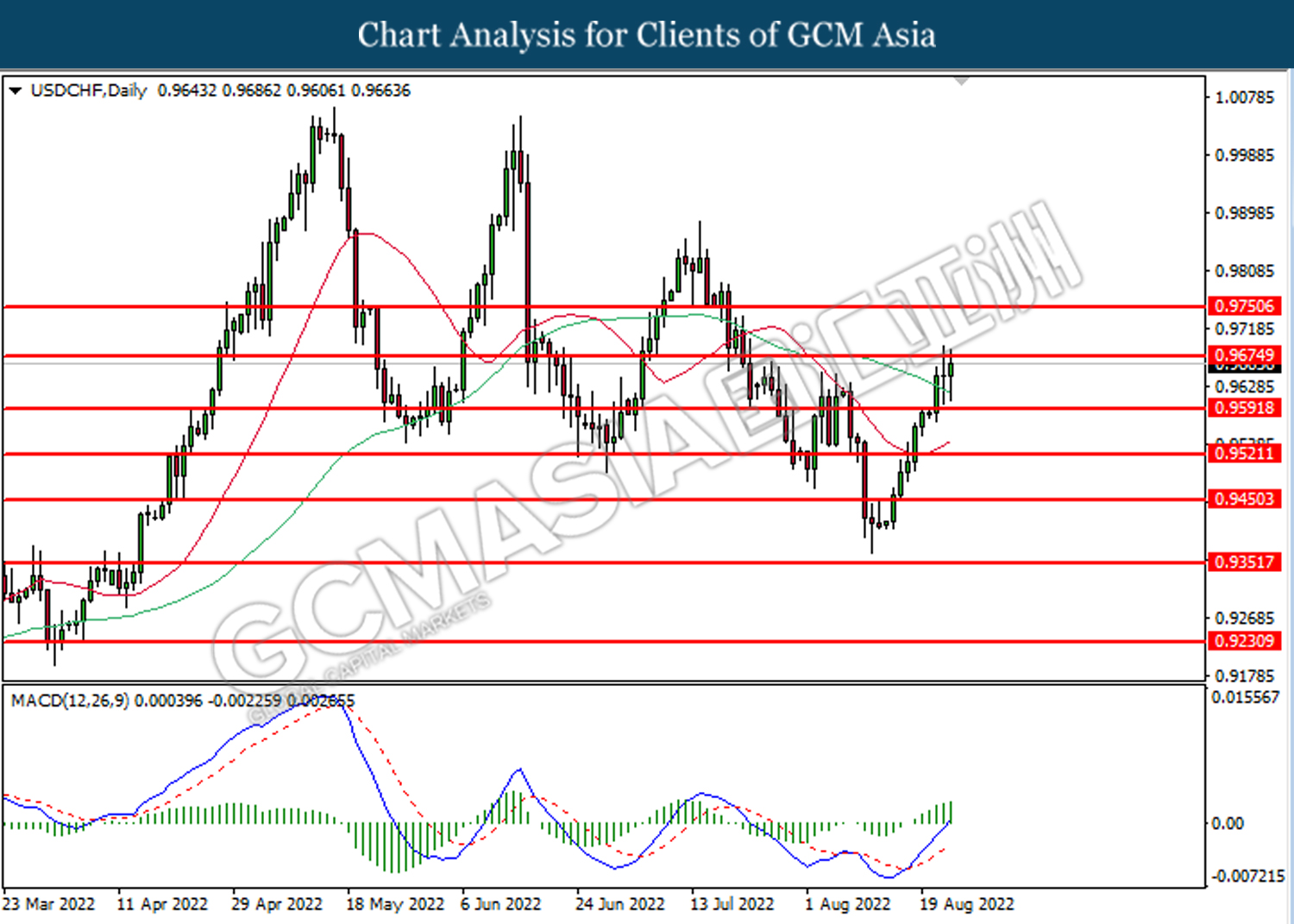

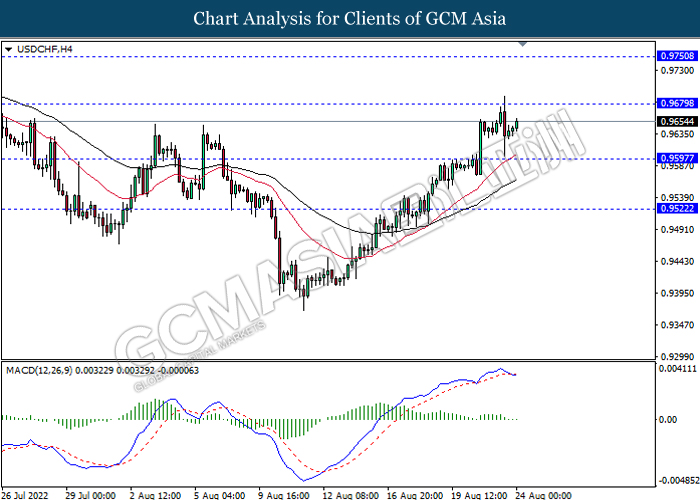

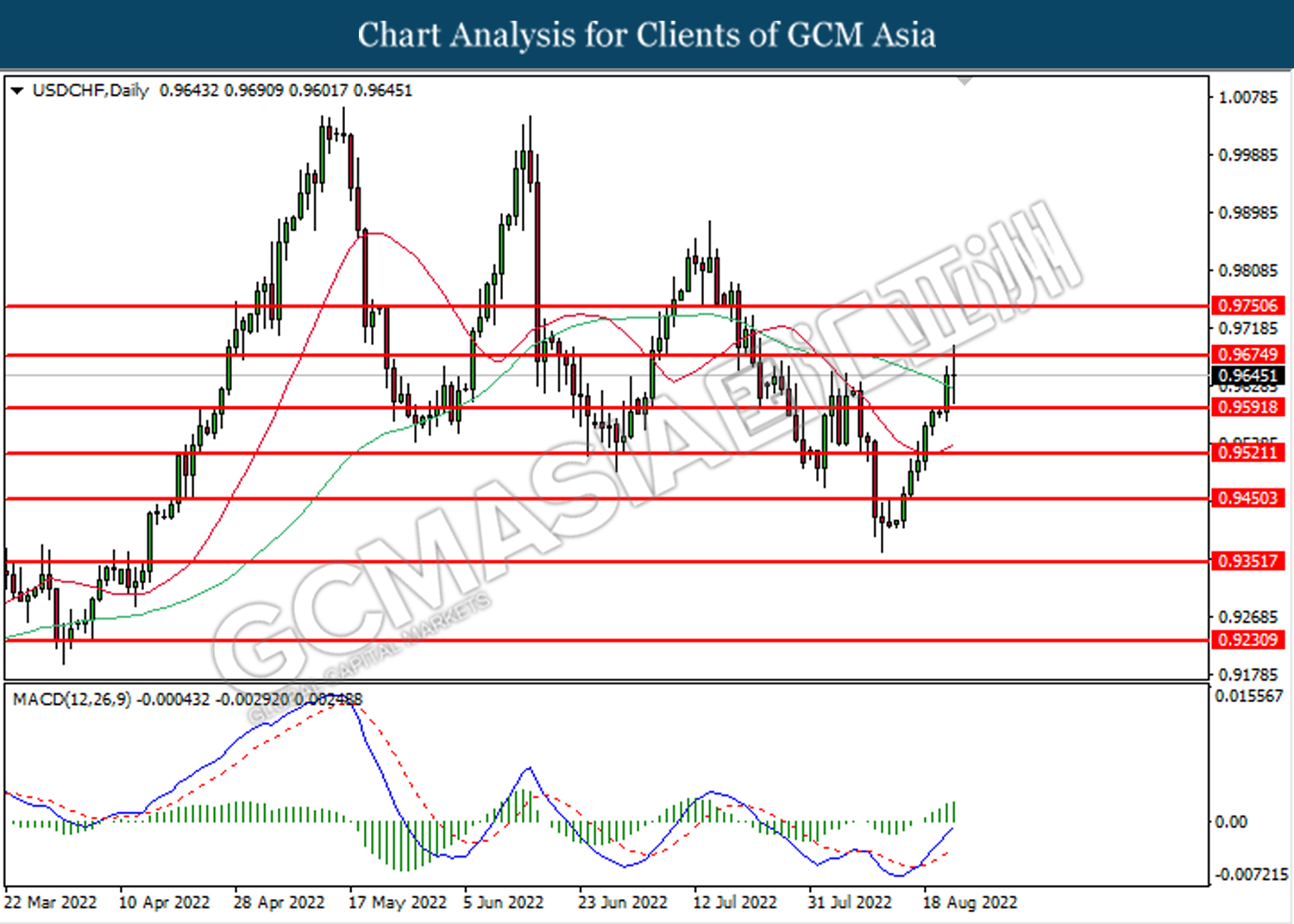

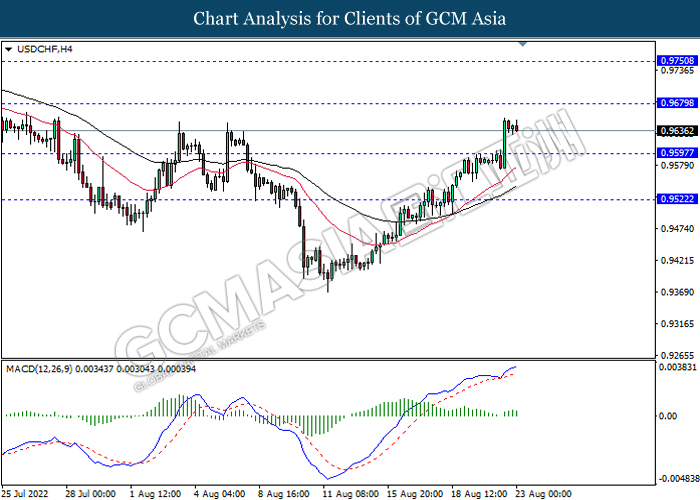

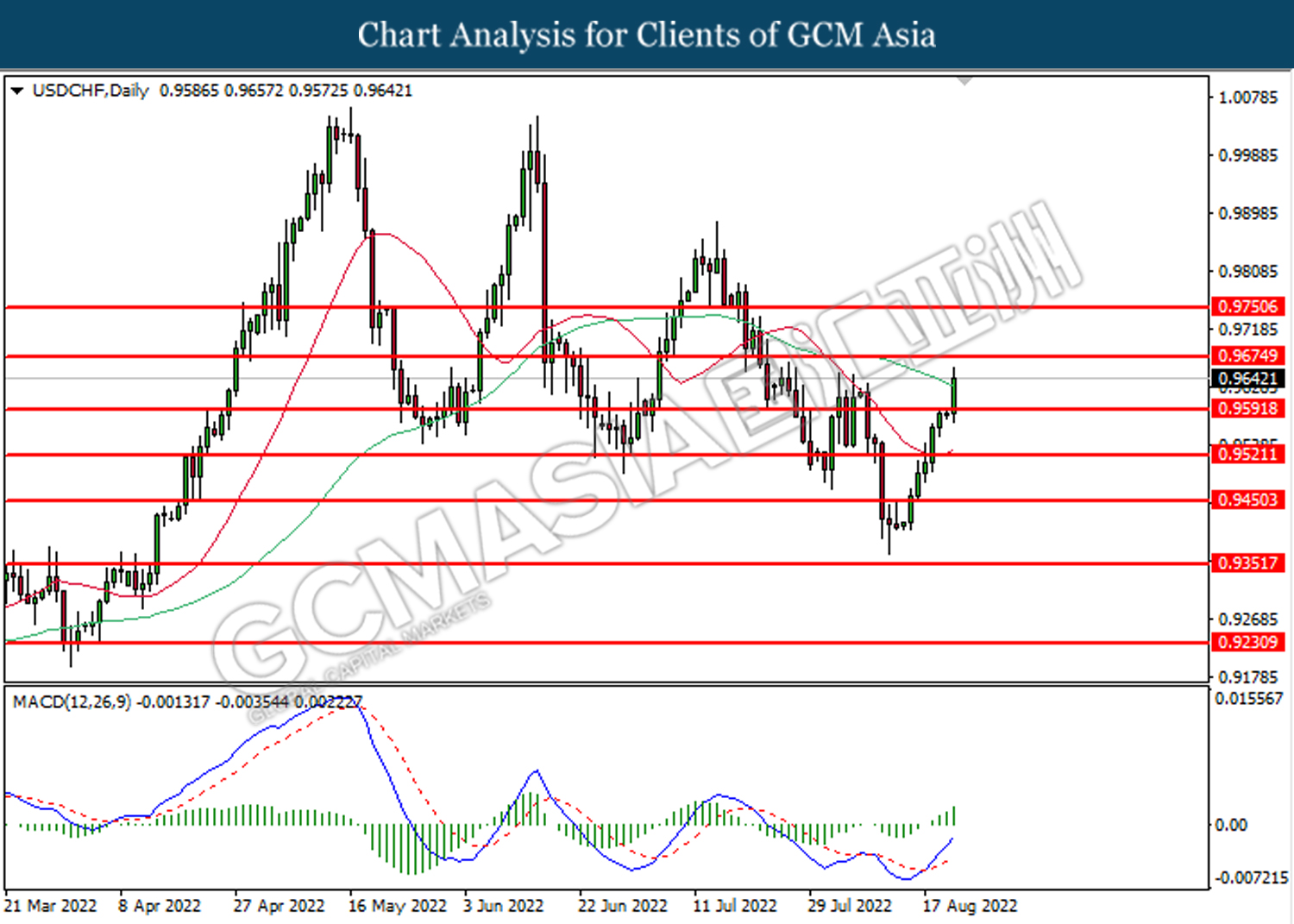

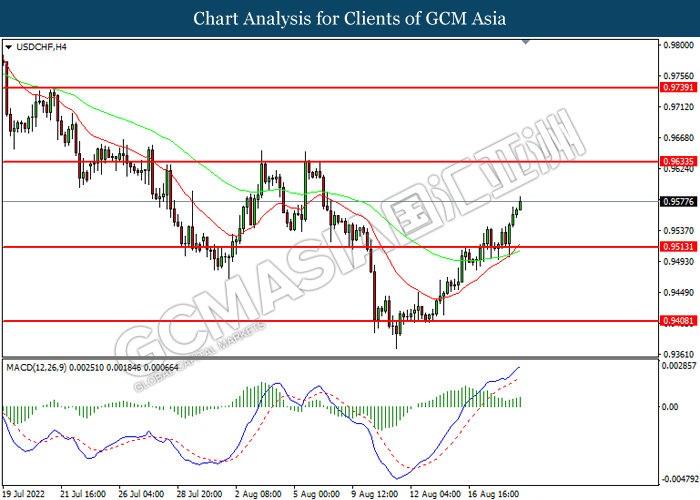

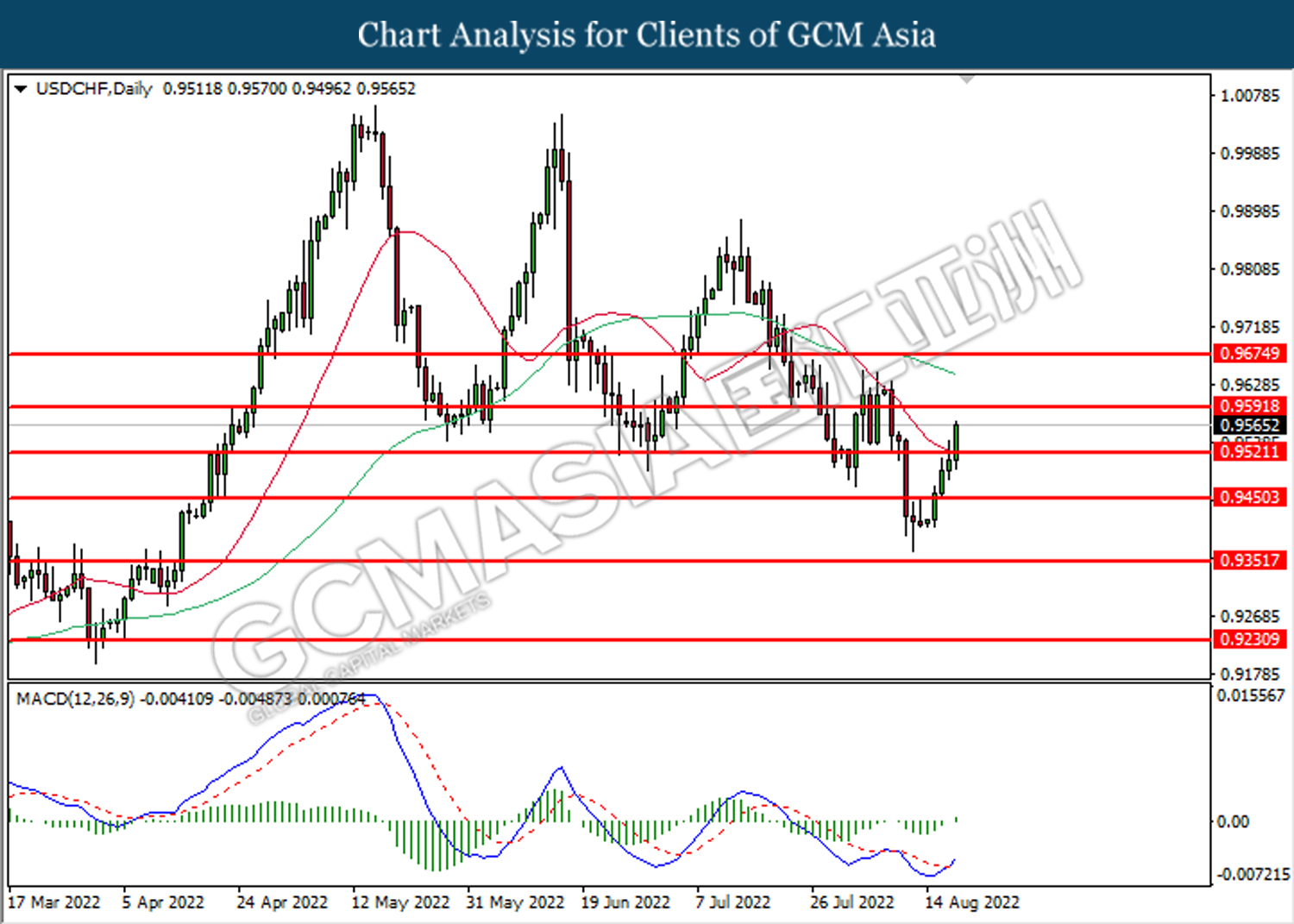

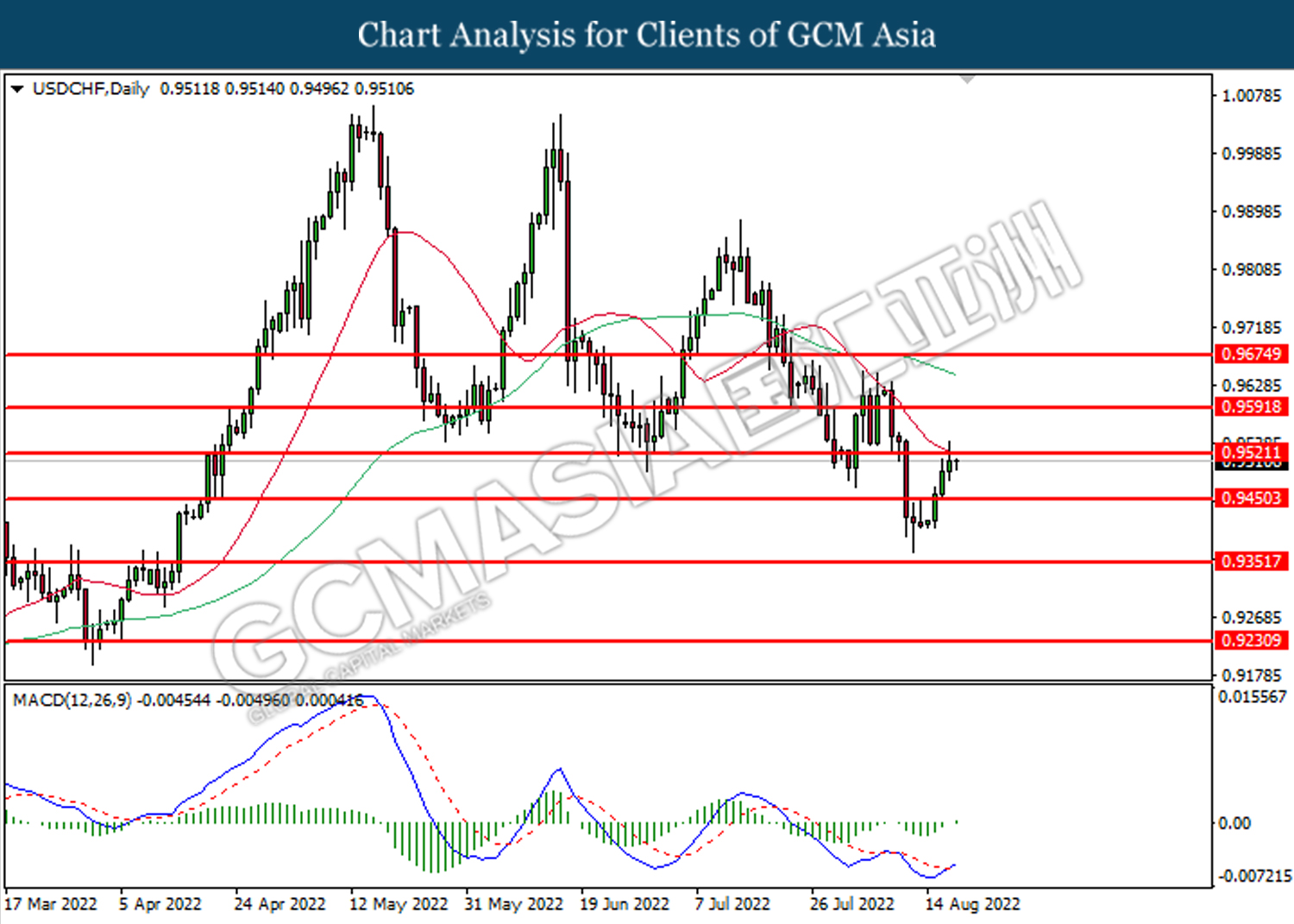

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

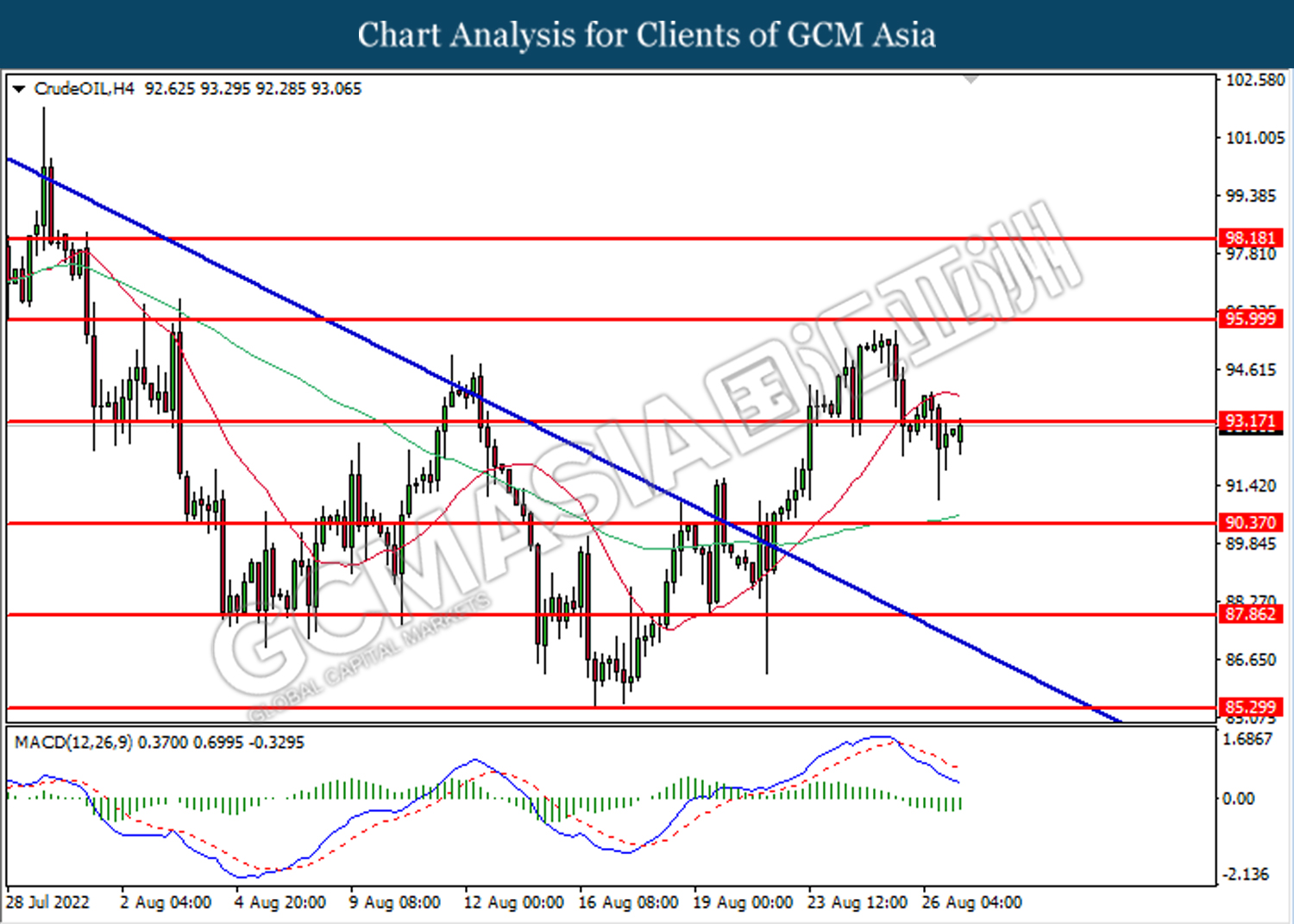

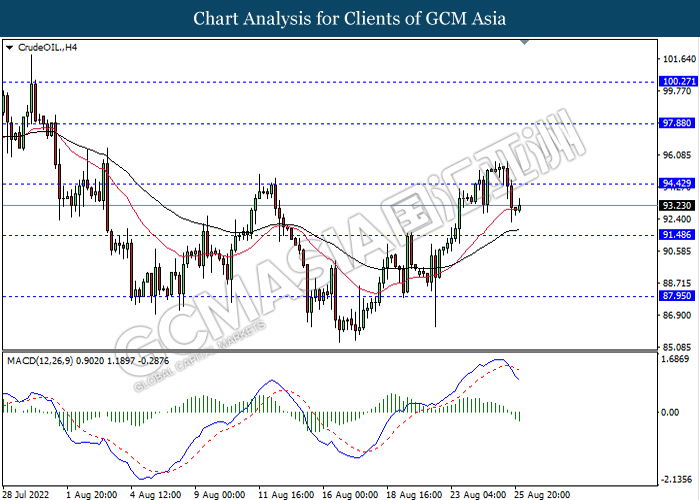

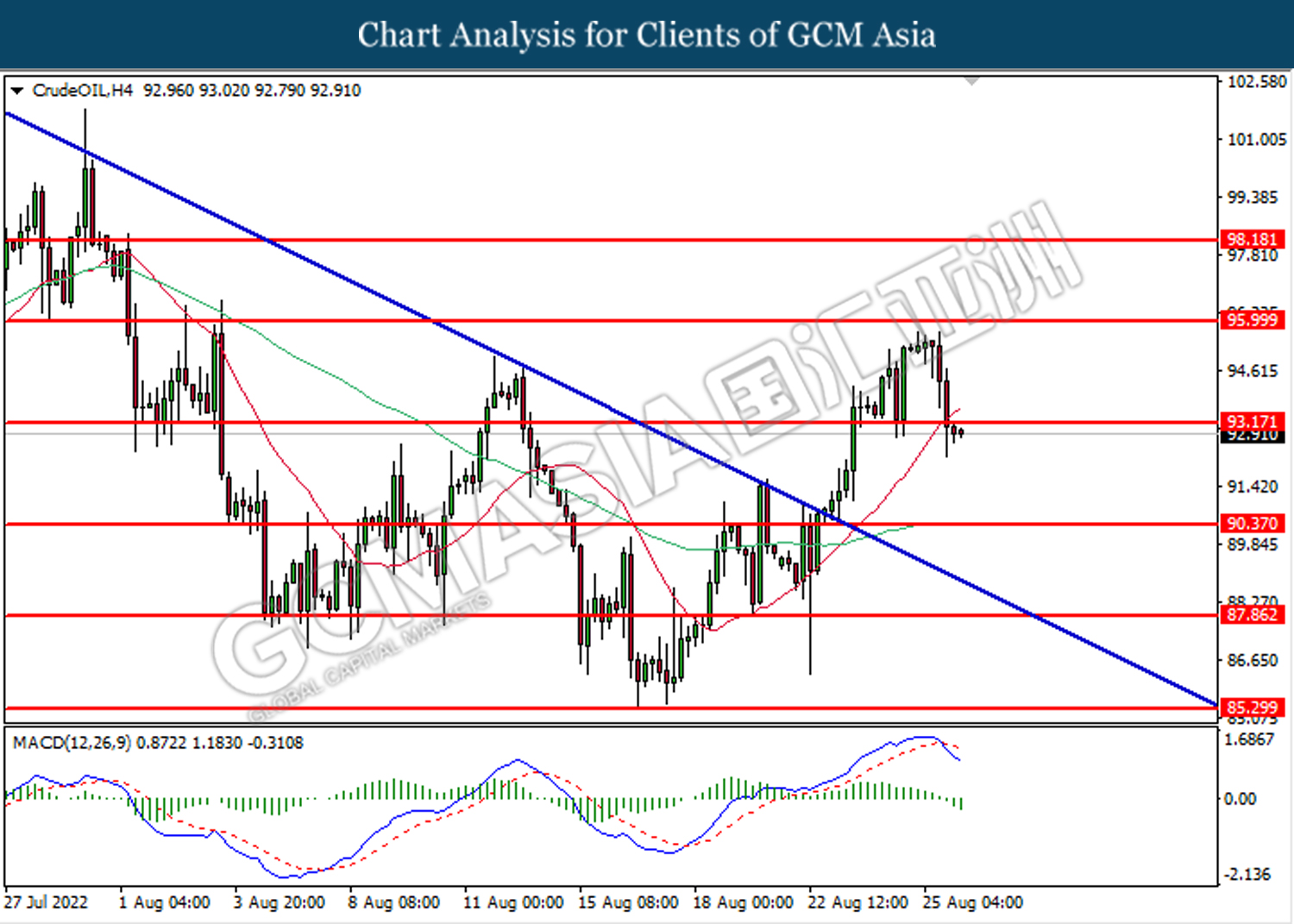

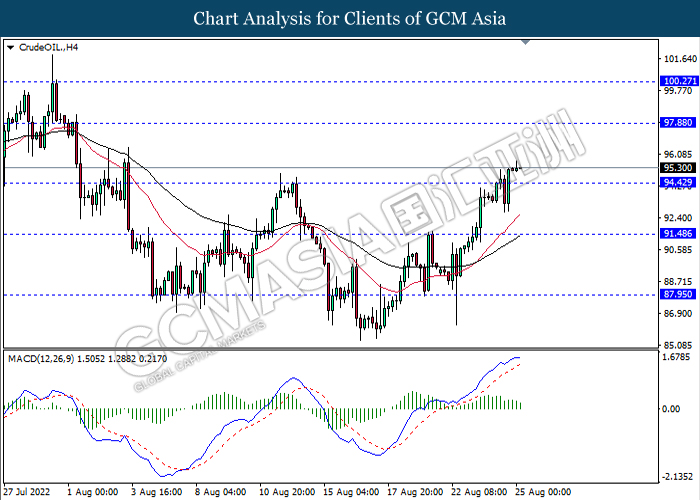

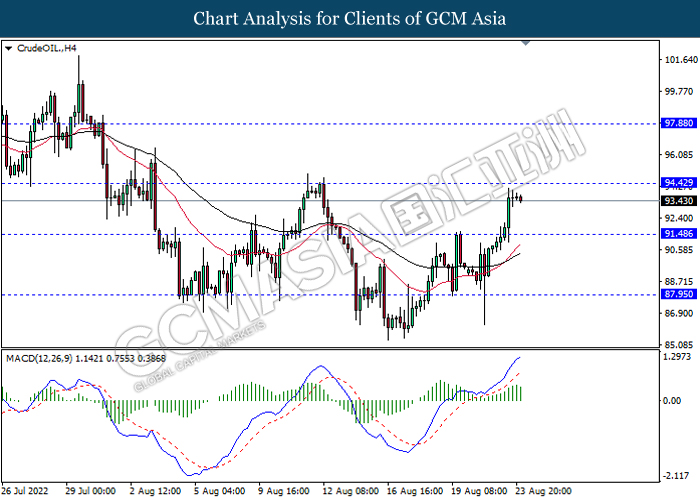

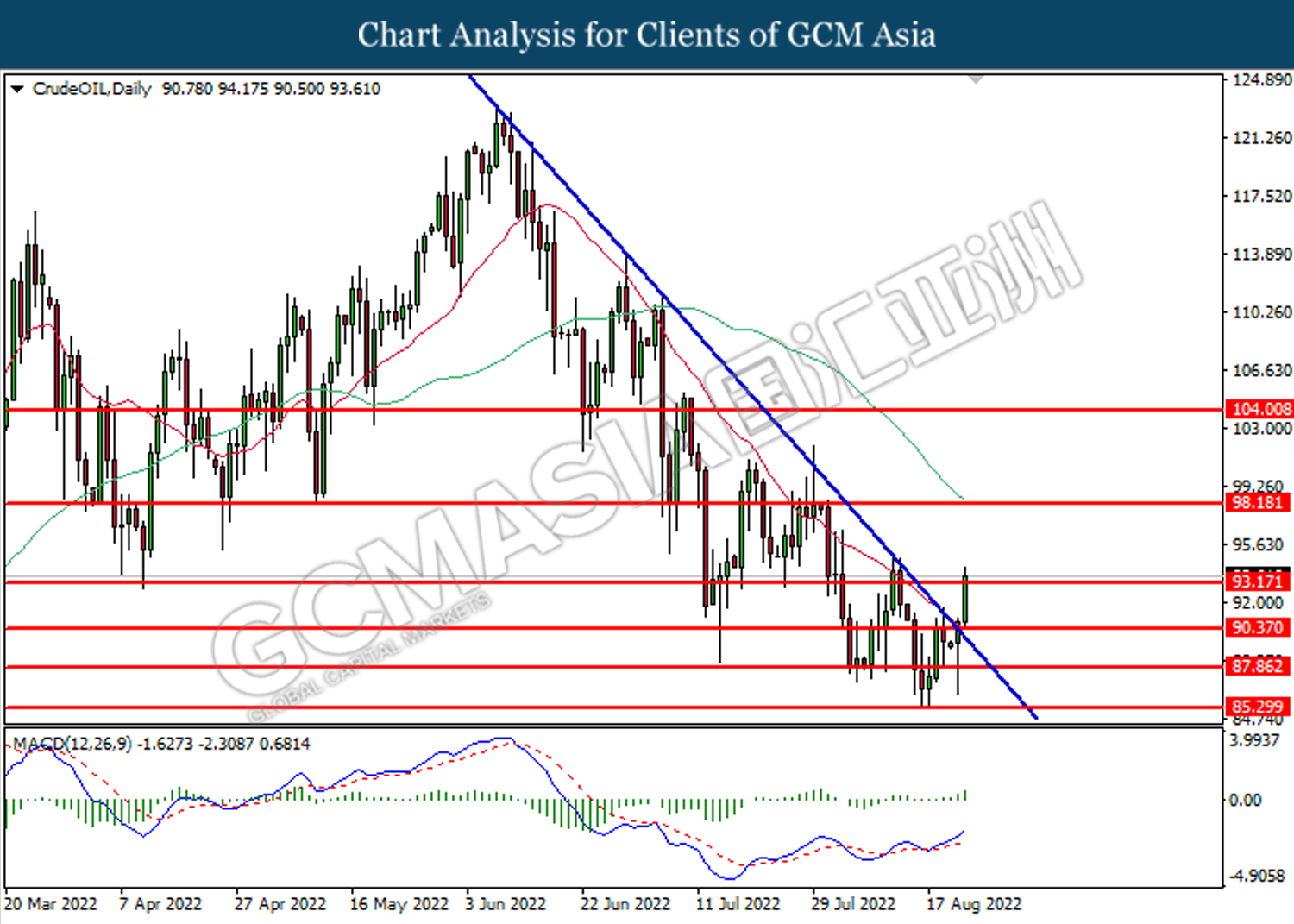

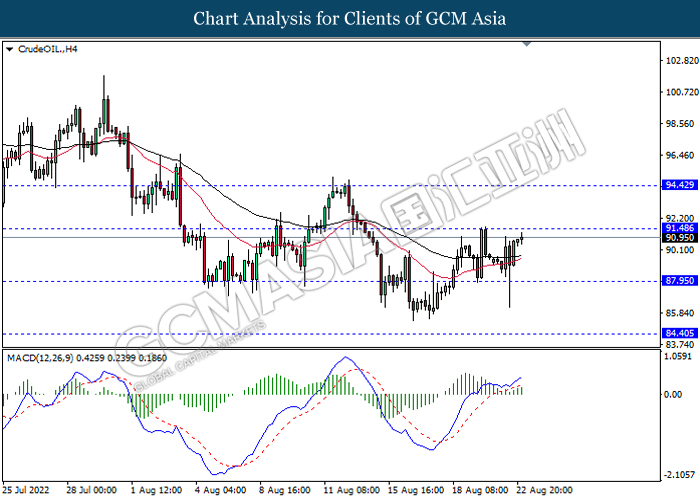

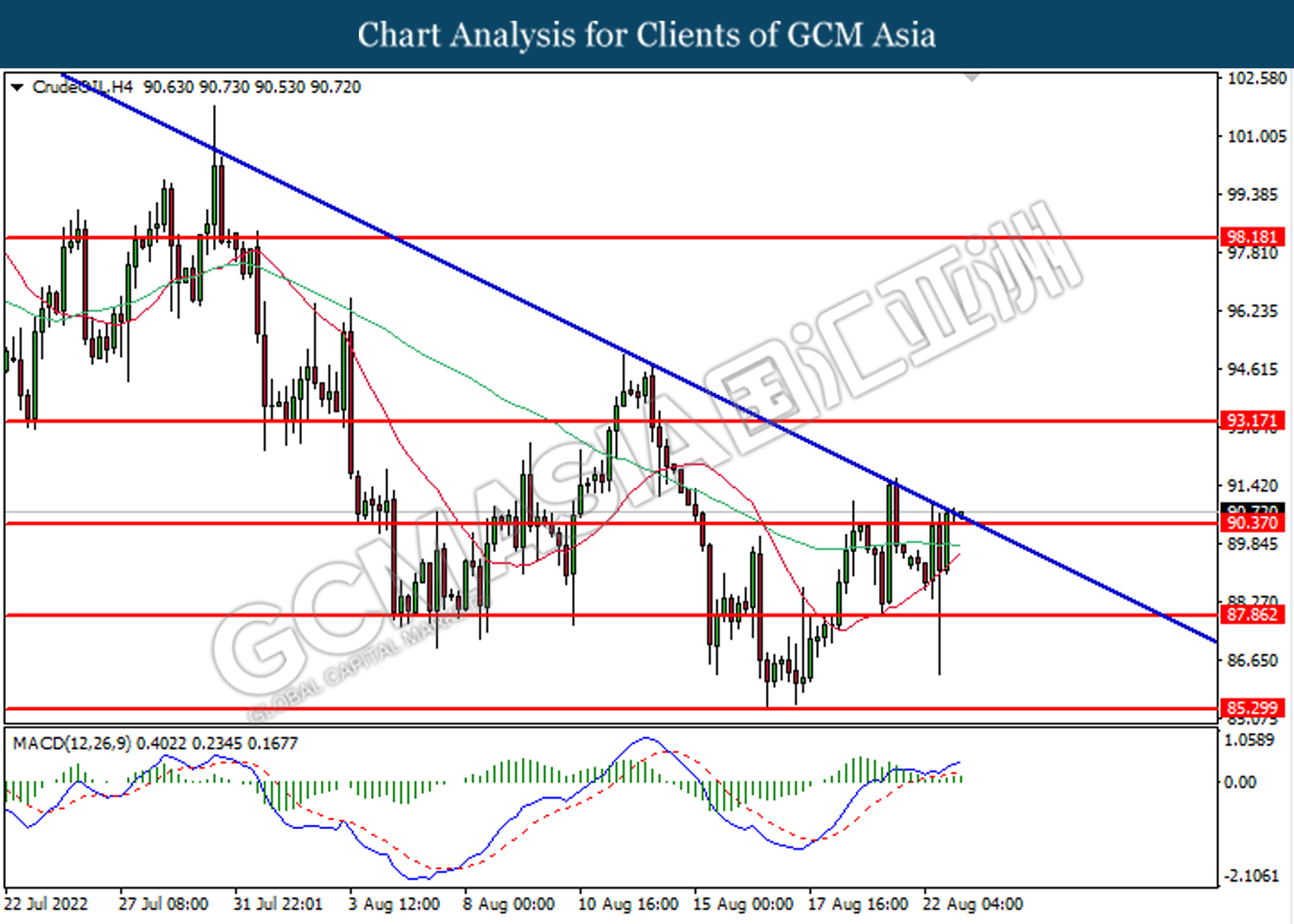

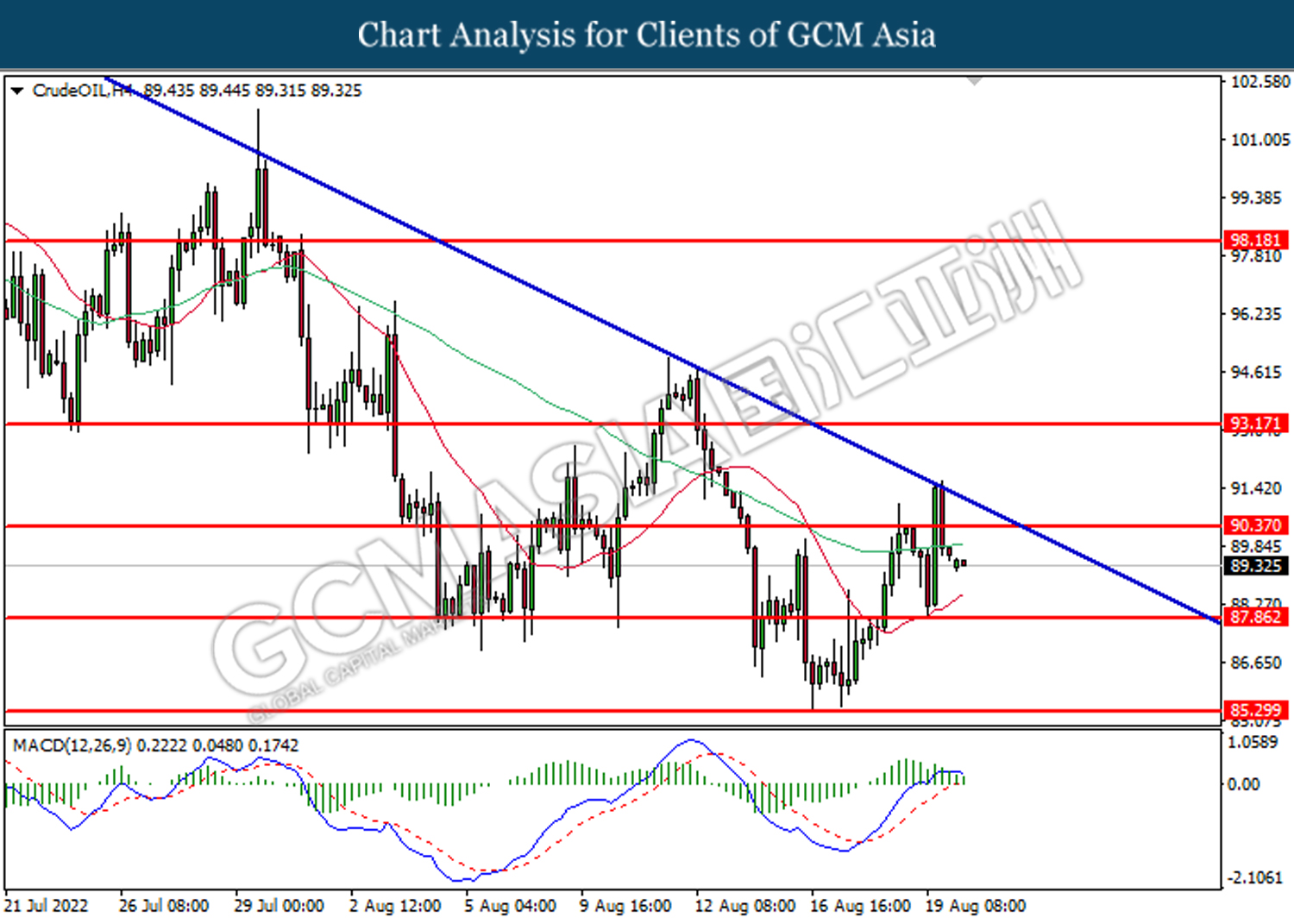

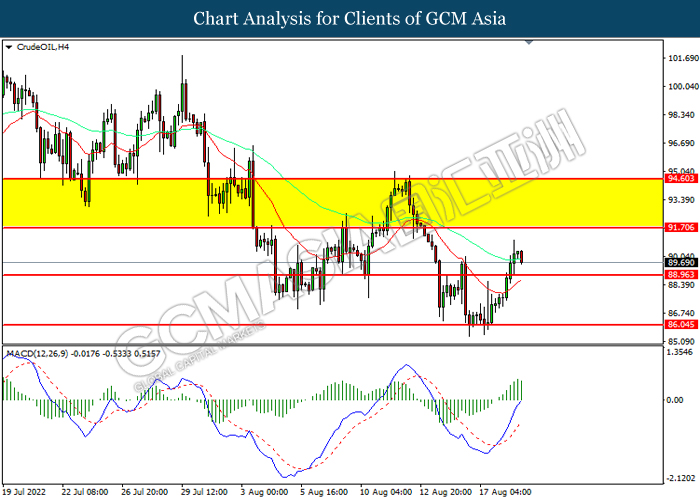

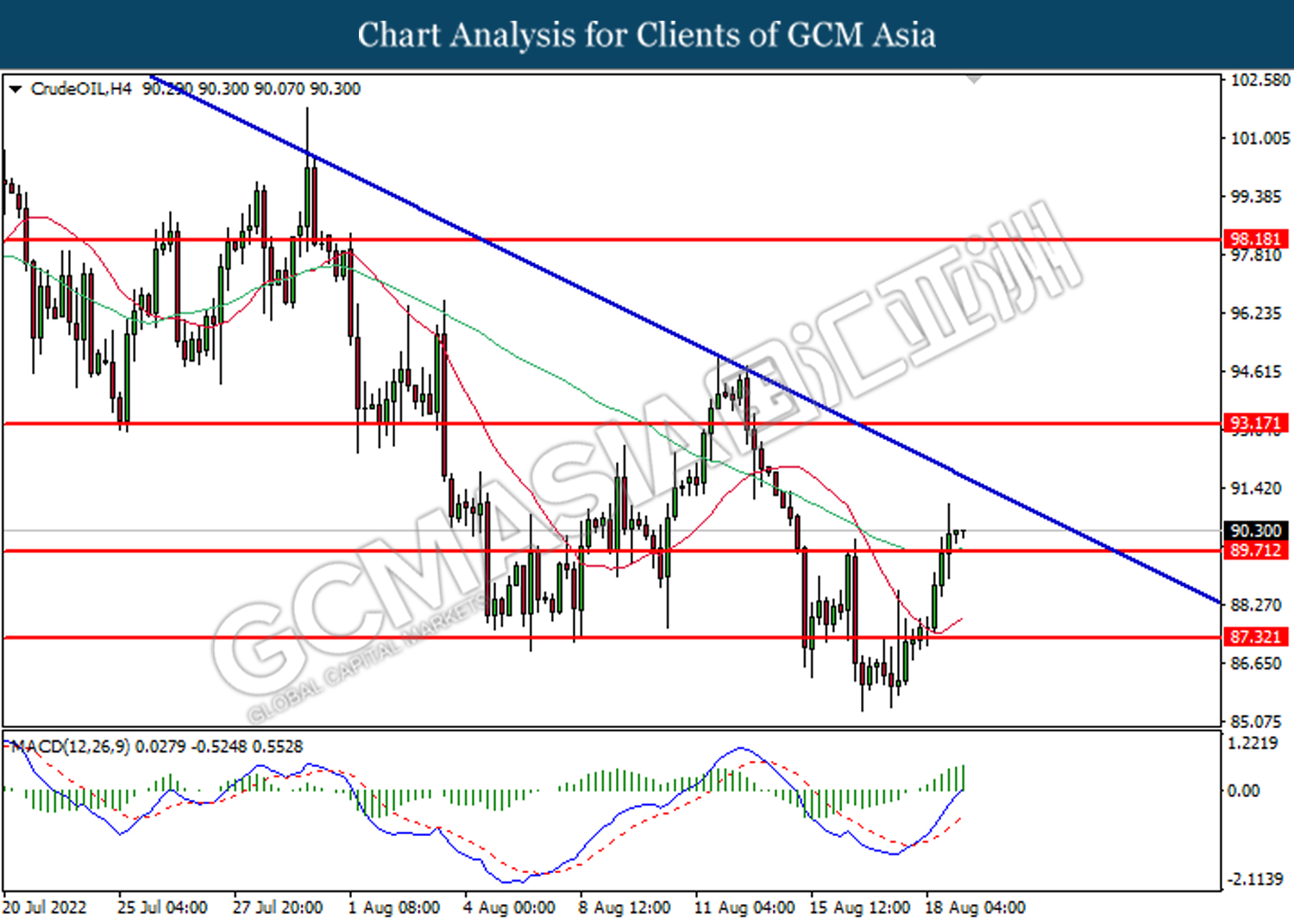

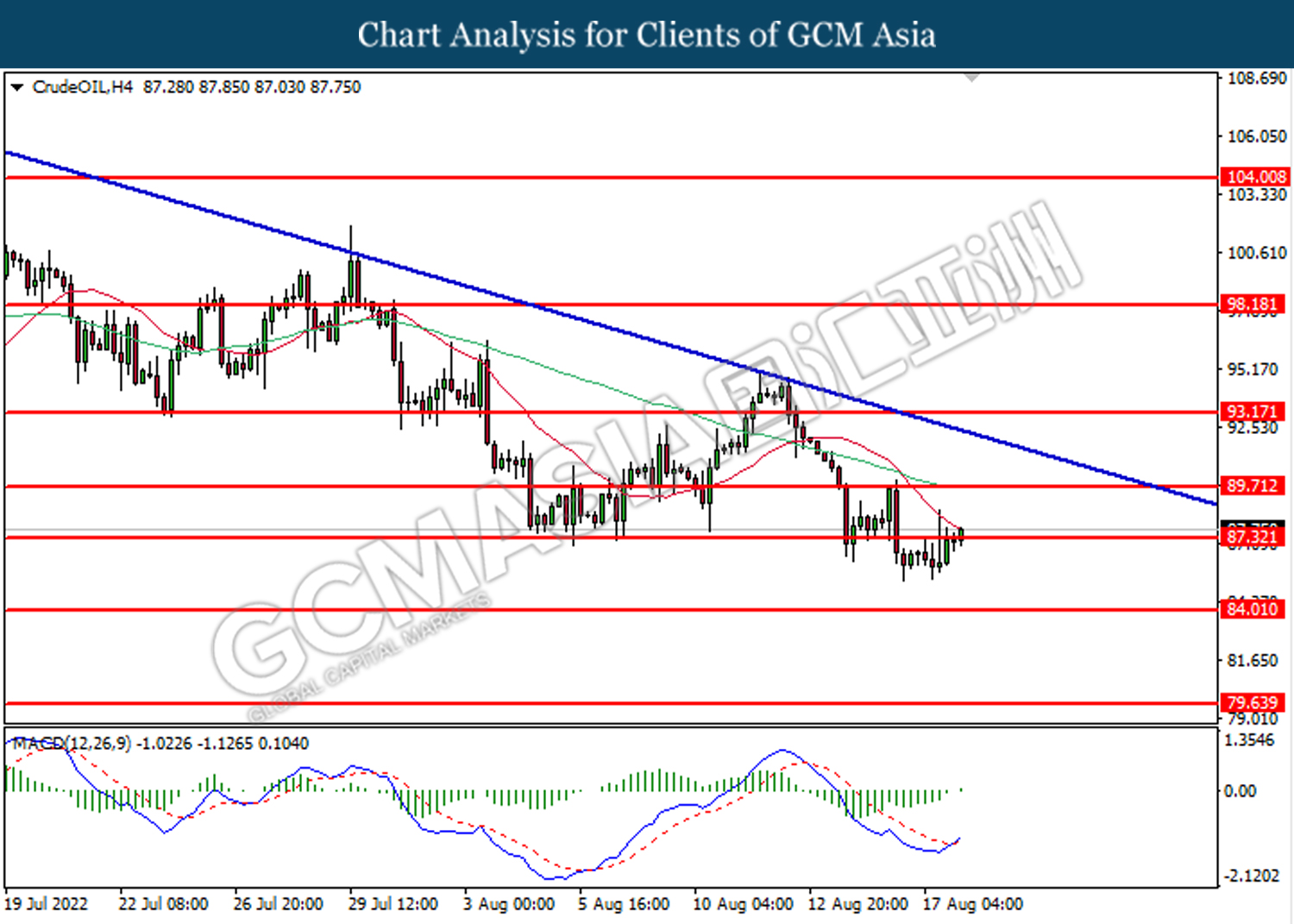

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 93.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.15, 96.00

Support level: 90.35, 87.85

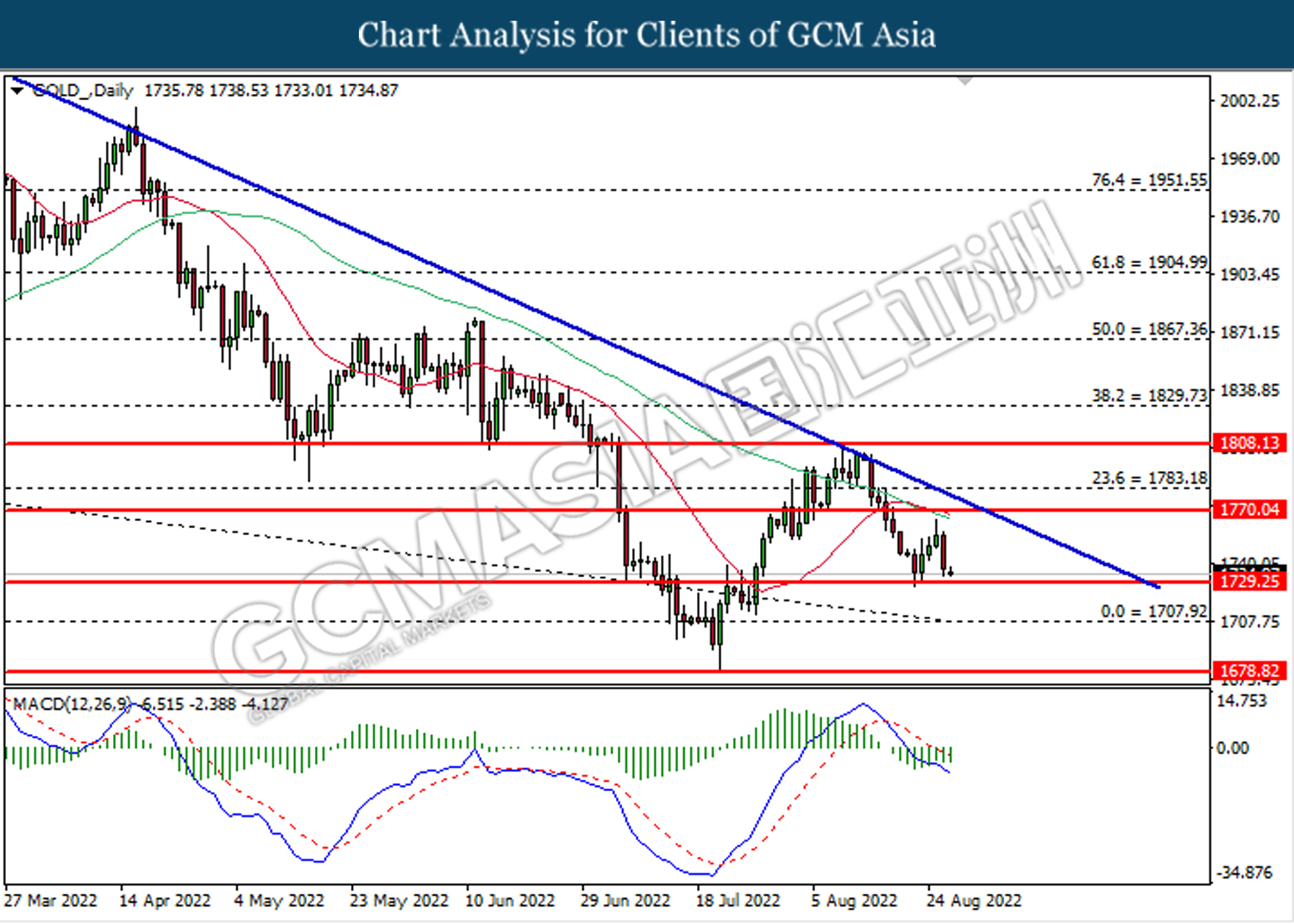

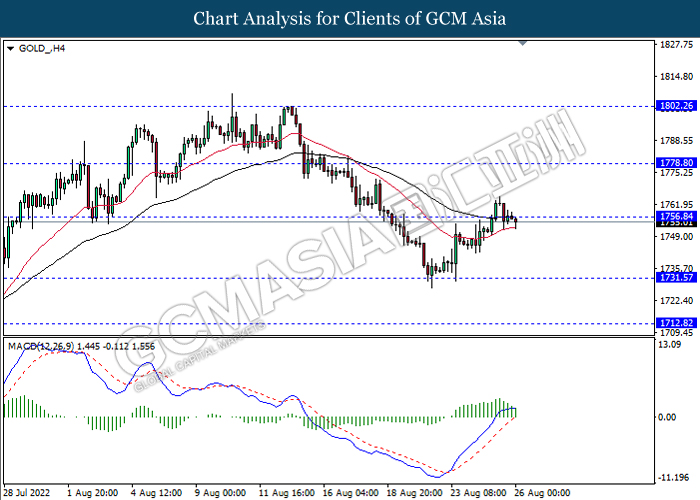

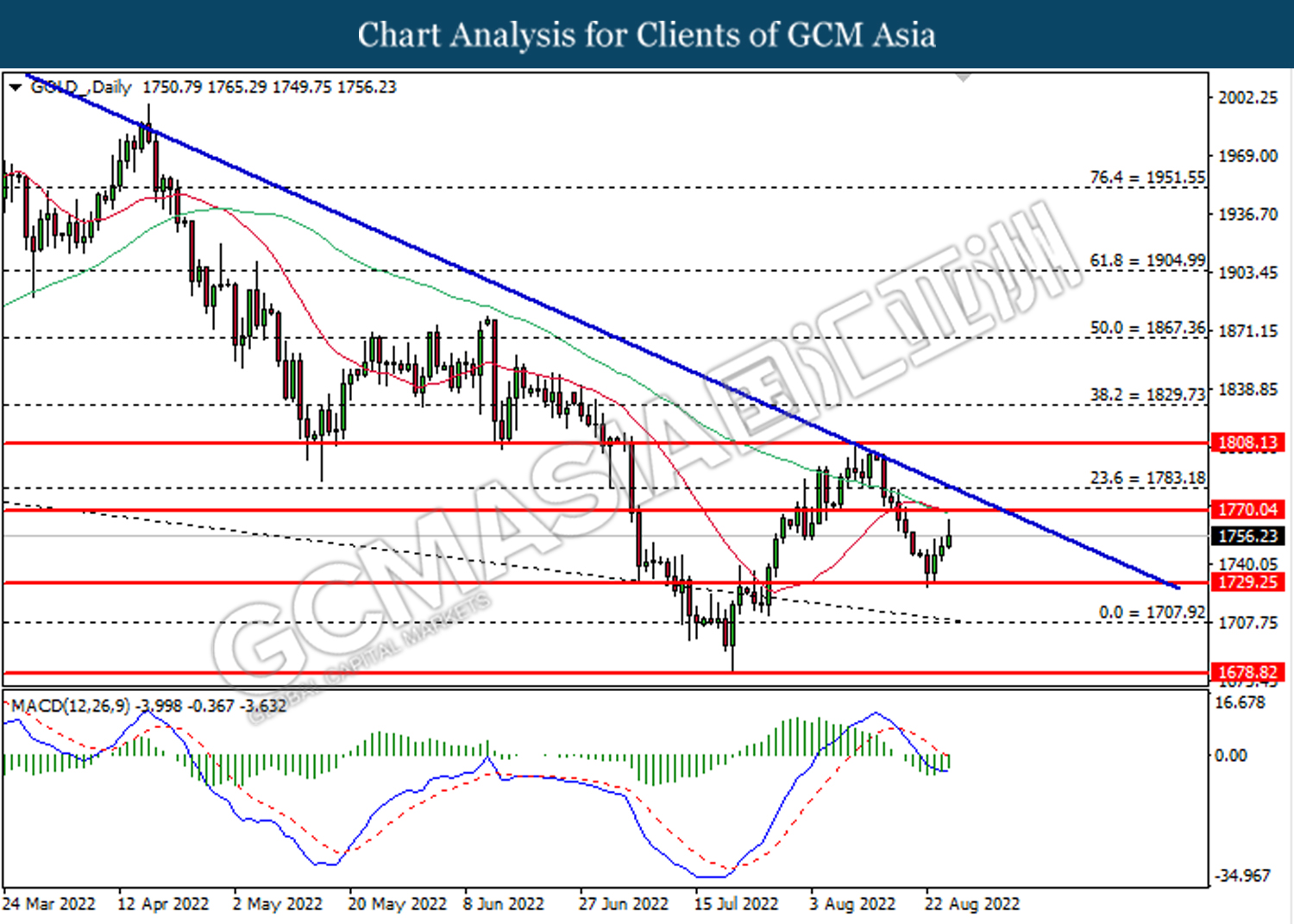

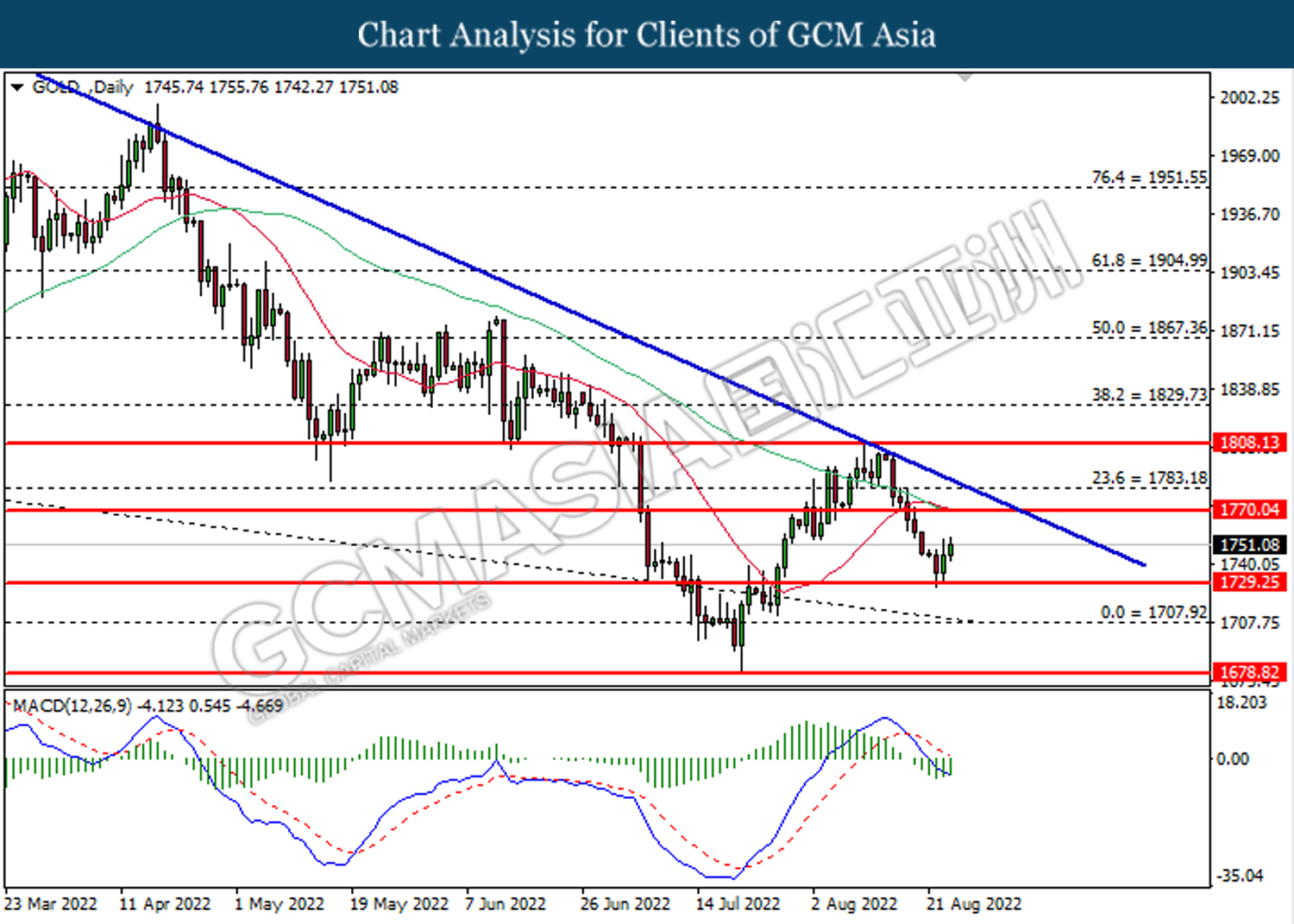

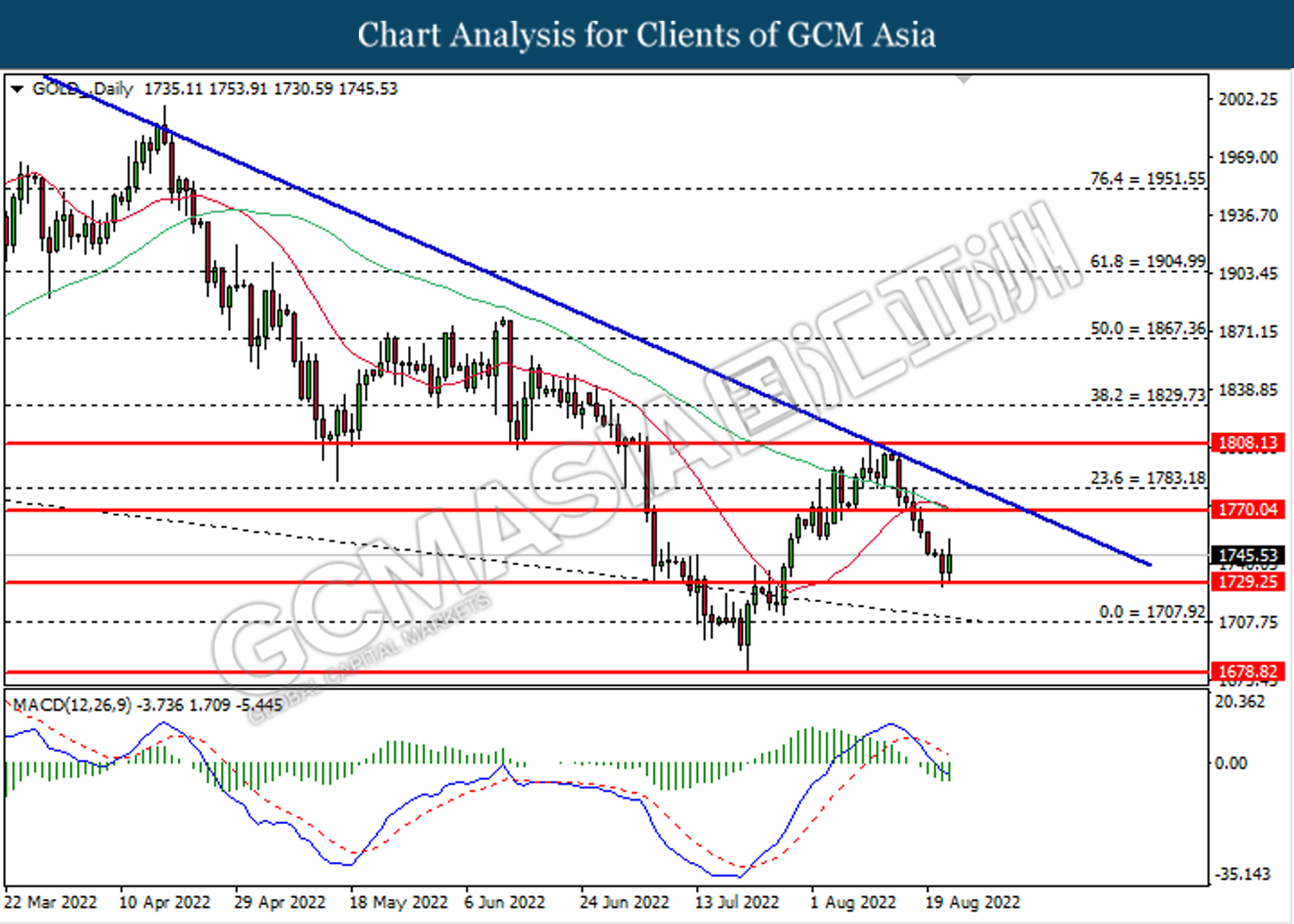

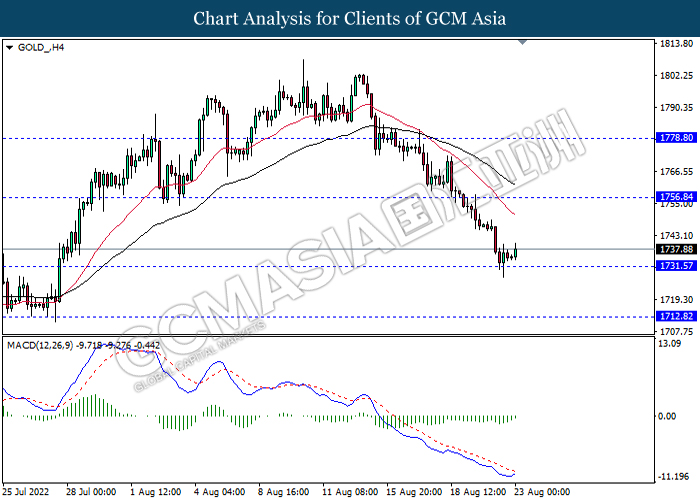

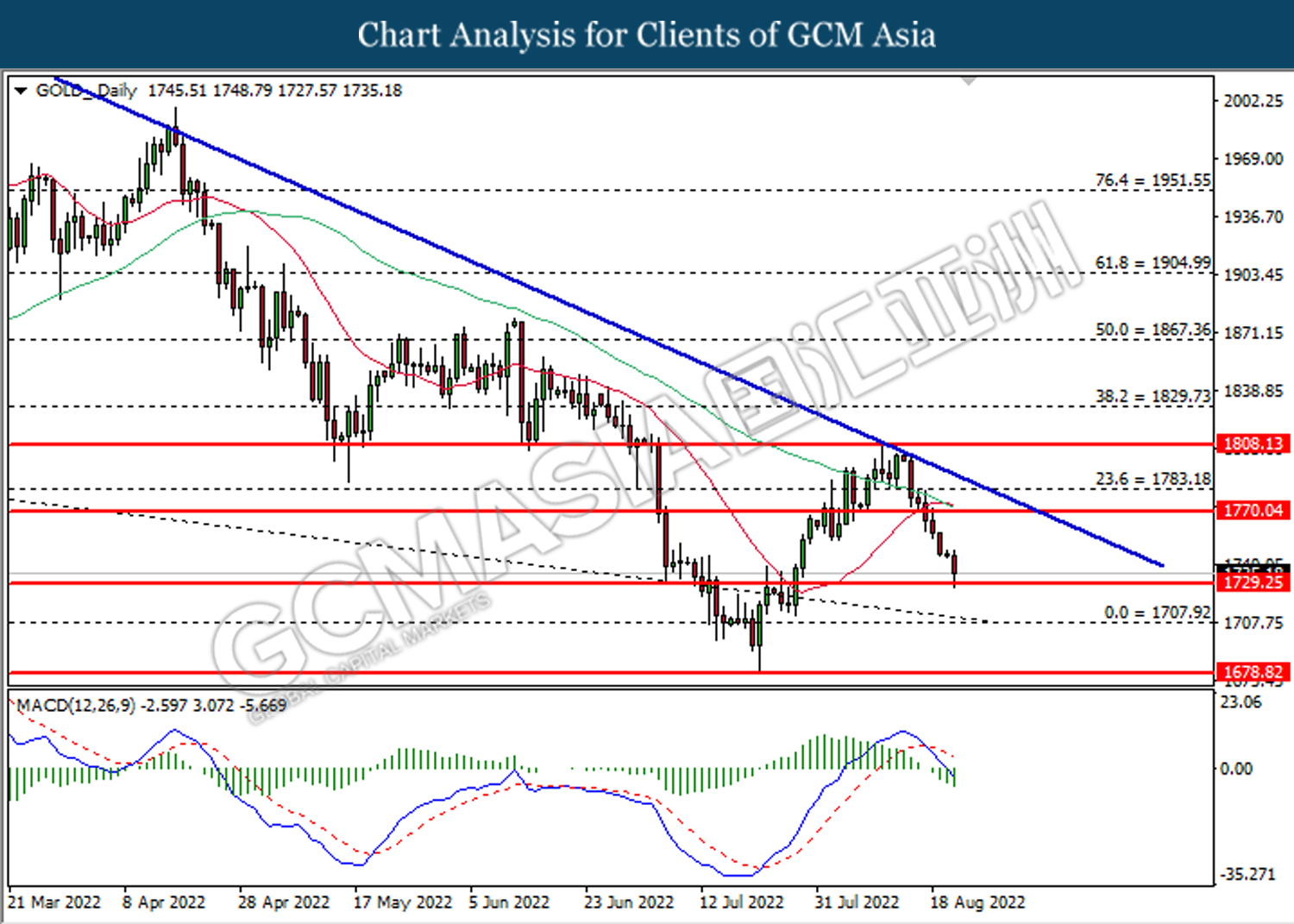

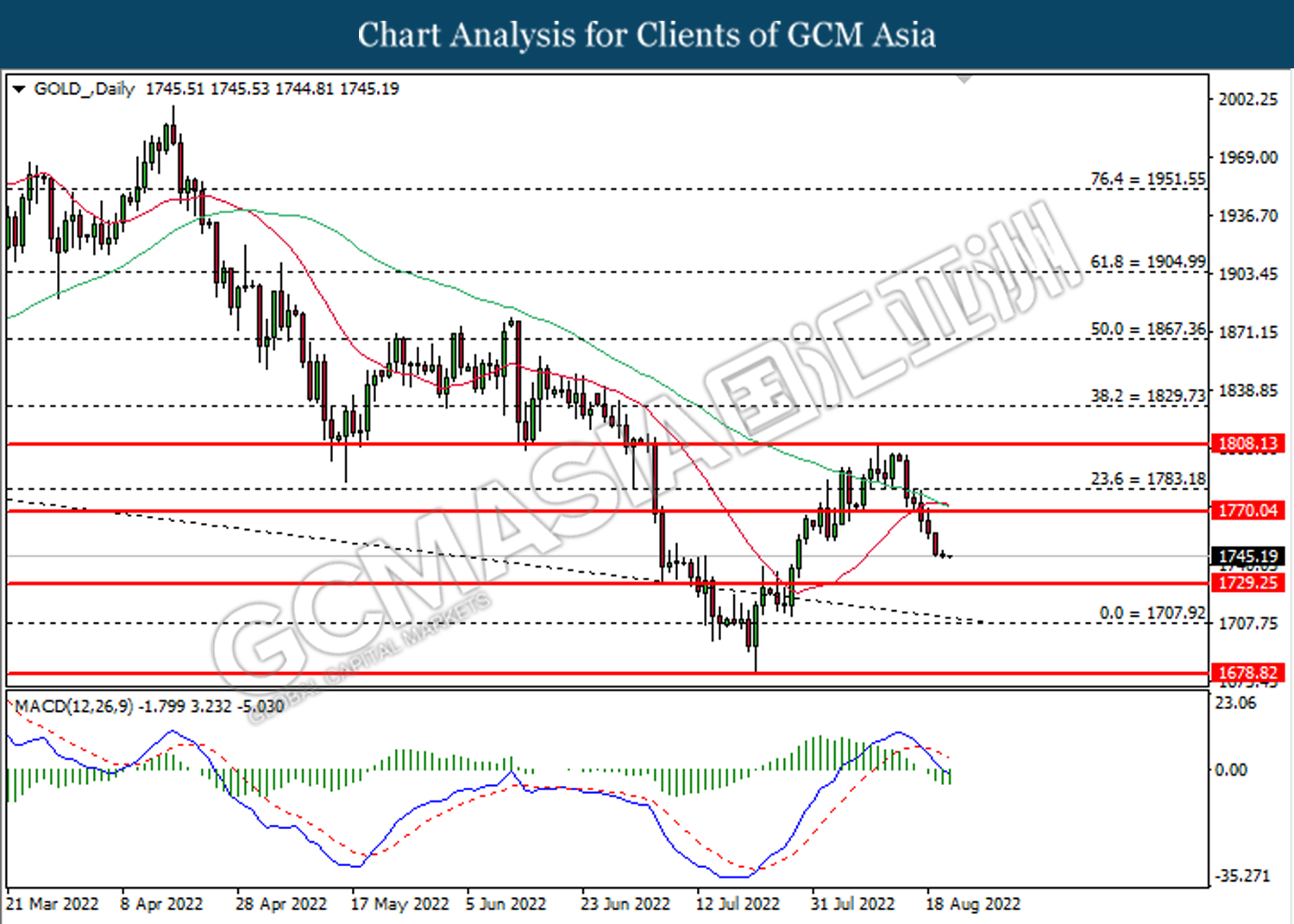

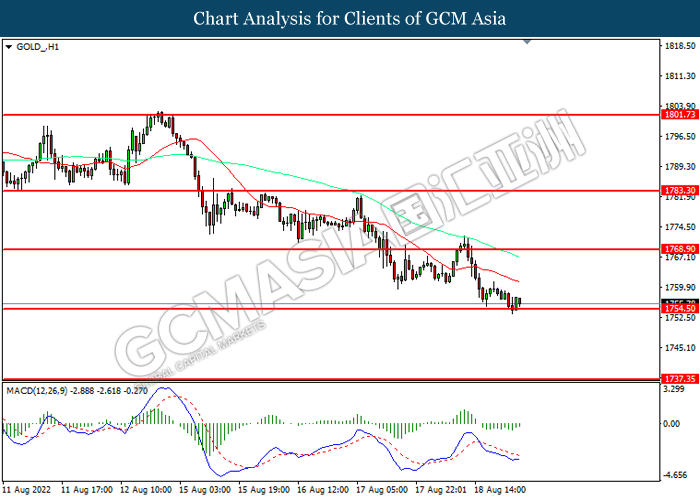

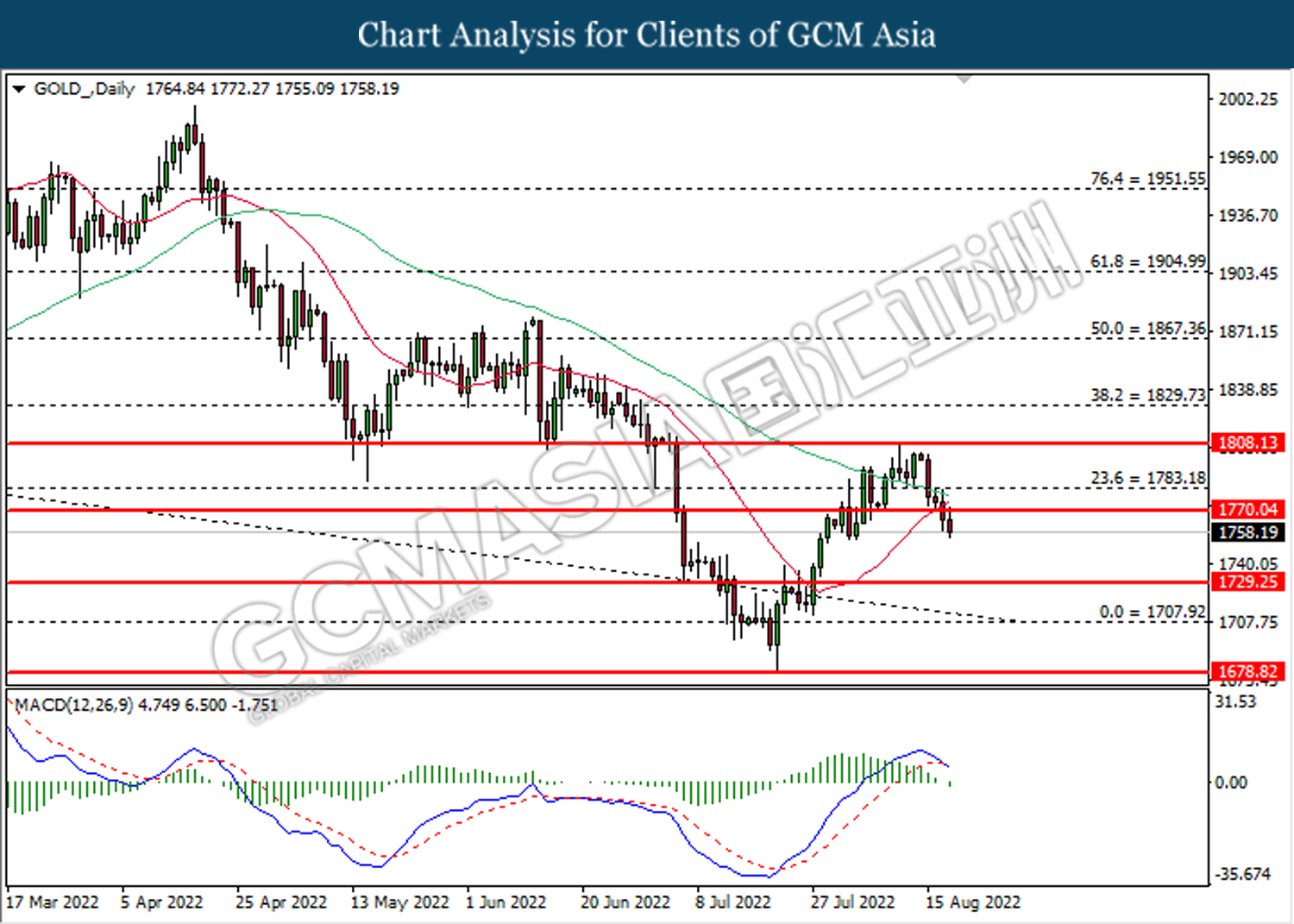

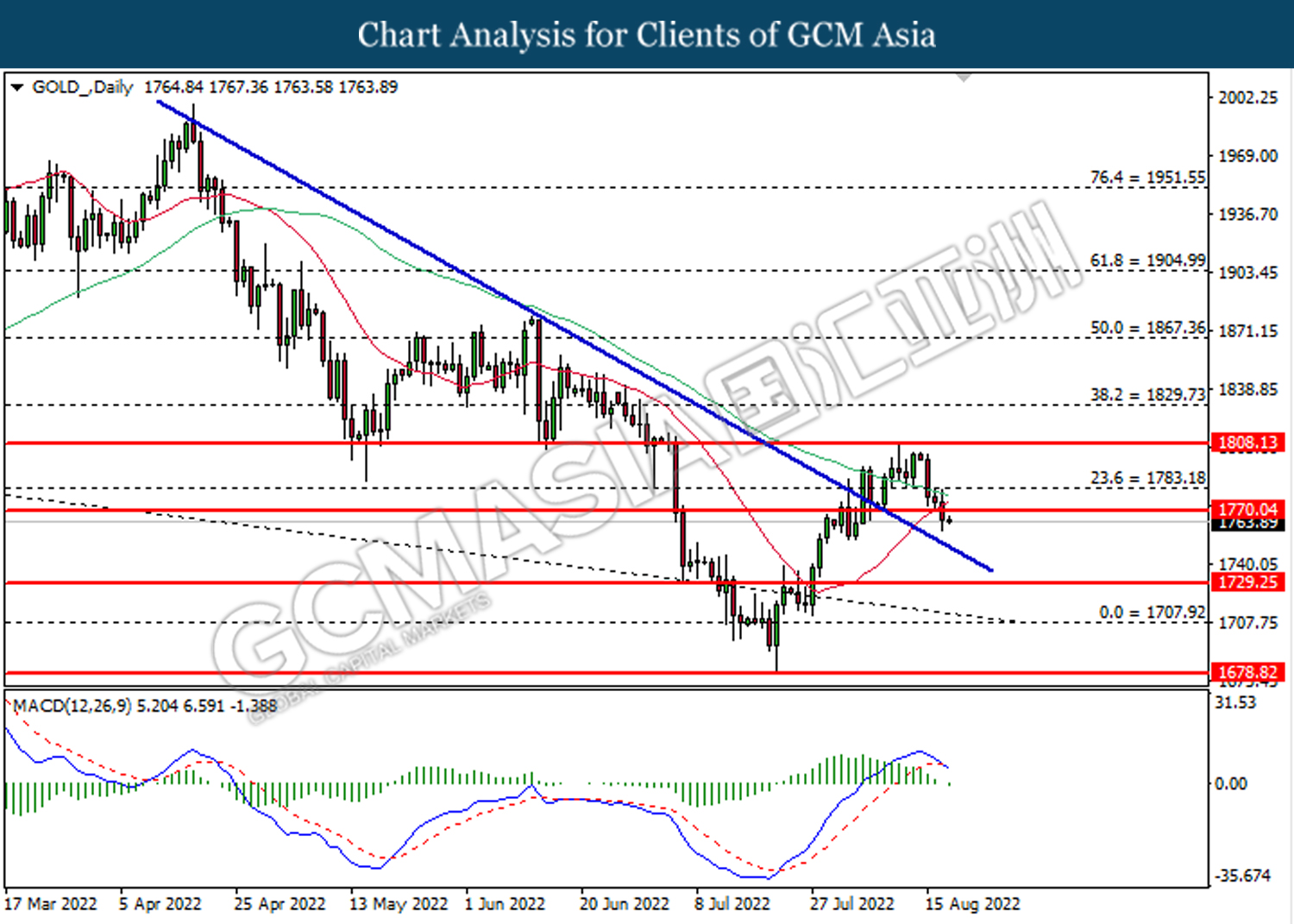

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1729.25. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

260822 Afternoon Session Analysis

26 August 2022 Afternoon Session Analysis

Yen slipped as BoJ stand with its loosen monetary policy.

The USD/JPY, which traded by global investors edged up on the early Friday over the dovish statement from Bank of Japan (BoJ). According to Reuters, the BoJ board member Toyoaki Nakamura claimed on Thursday that the central bank would maintain its ultra-low rates in order to tackle the current economy slowdown. Besides, he reiterated that the implementation of rate increase by major central banks for stabilizing inflation risk would likely to trigger an outflow of capital from emerging economies, which dragging down the global economic prospects. As the monetary policy of Japan remained divergence against other central banks, market participants tend to shift their capitals away from Japan markets as well as eyeing on other currencies. Nonetheless, the gains of USD/JPY was limited amid the upbeat economic data. According to Statistics Bureau, the Japan Tokyo Core Consumer Price Index (CPI) YoY for August notched up from the previous reading of 2.3% to 2.6%, exceeding the market forecast of 2.5%. As of writing, USD/JPY rose by 0.17% to 136.74.

In the commodities market, the crude oil price appreciated by 0.93% to $93.38 per barrel as of writing after a sharp decline throughout overnight trading session amid the expectation of hawkish speech from Fed President. On the other hand, the gold price dropped by 0.20% to $1755.05 per troy ounce as of writing as the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Jul) | 0.6% | 0.3% | – |

Technical Analysis

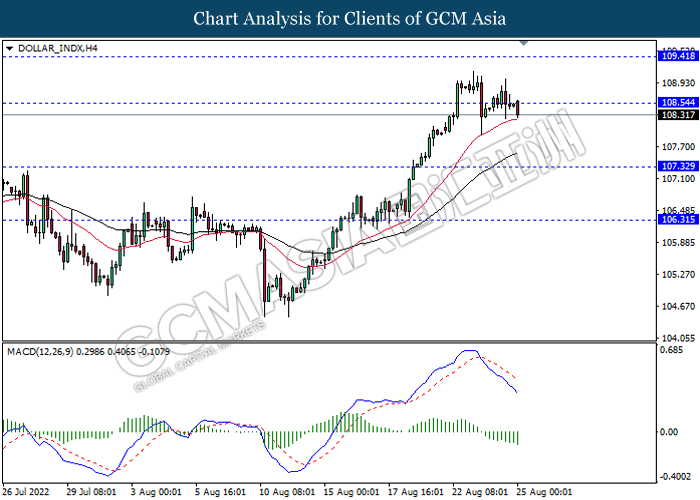

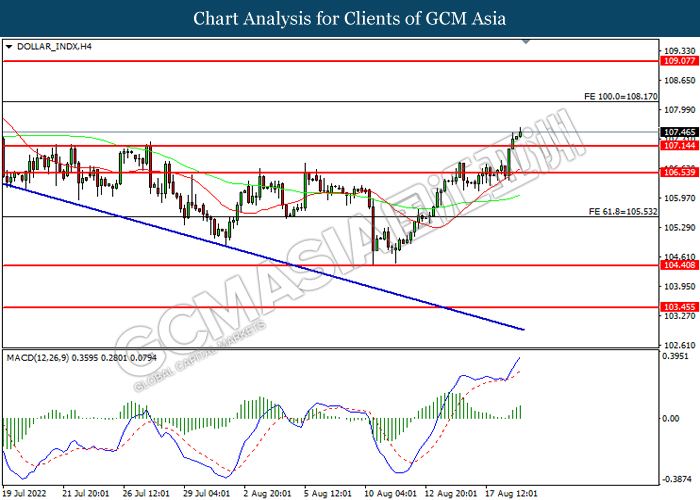

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

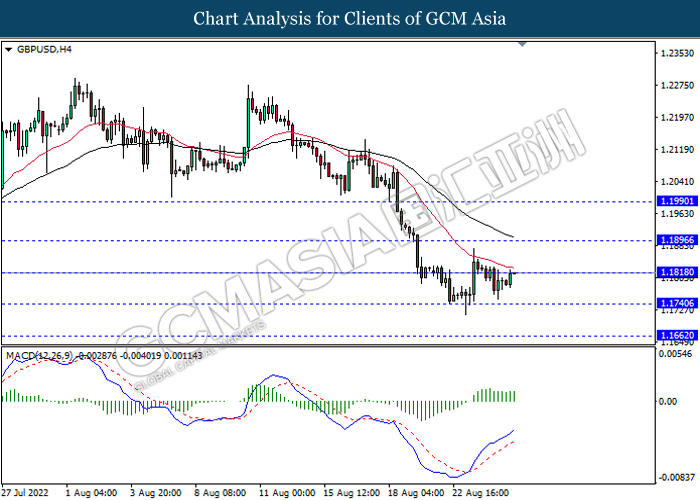

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1895, 1.1990

Support level: 1.1820, 1.1740

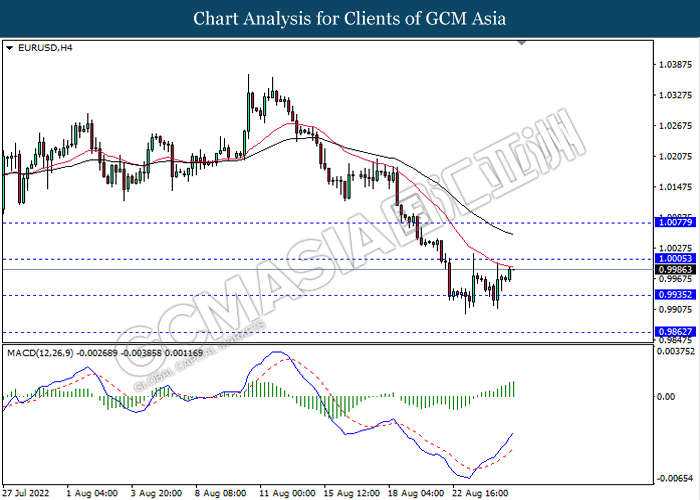

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

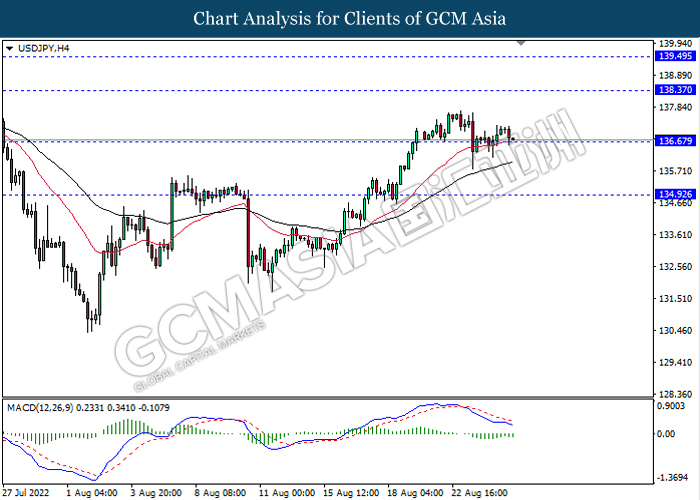

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7090

Support level: 0.6930, 0.6865

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

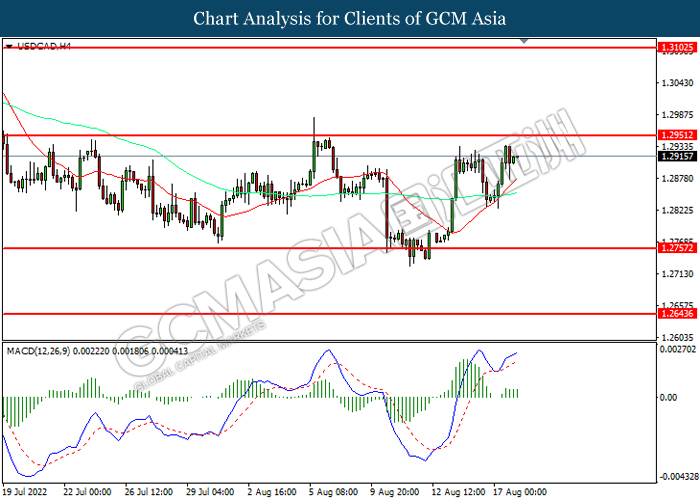

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2935, 1.3050

Support level: 1.2825, 1.2735

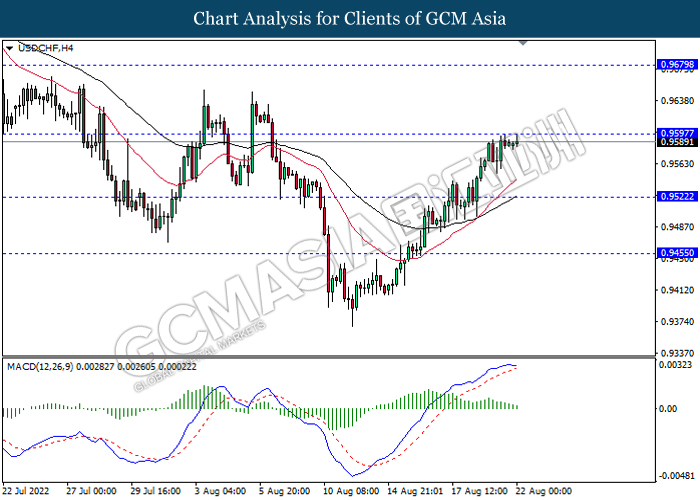

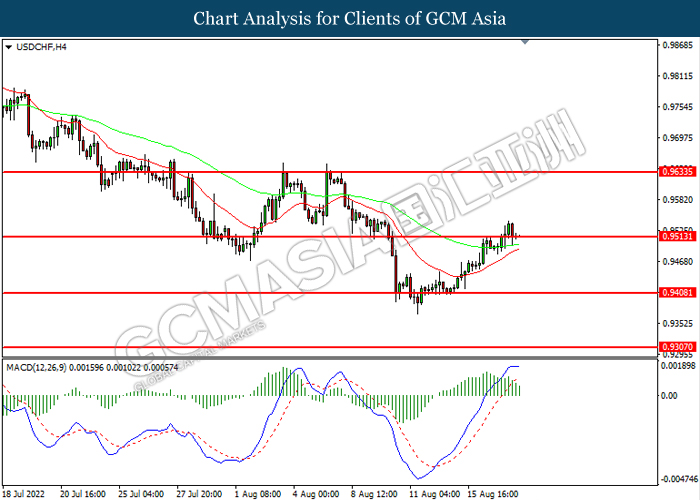

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

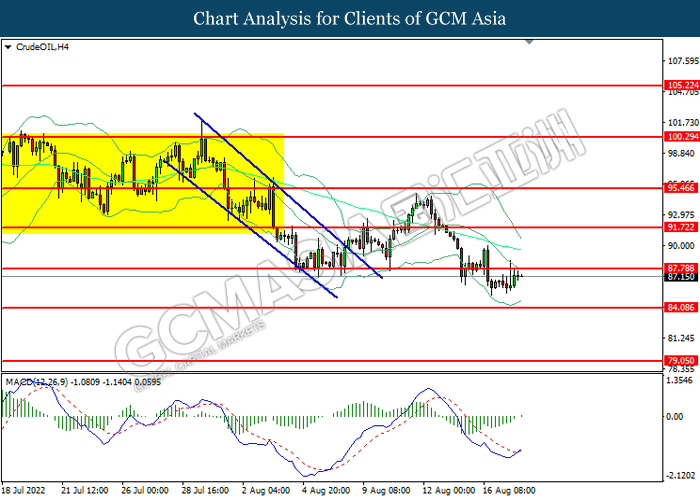

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 94.40, 97.90

Support level: 91.50, 87.95

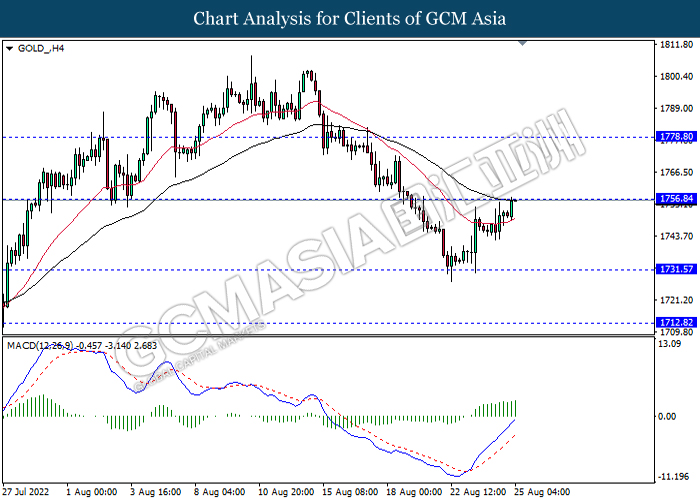

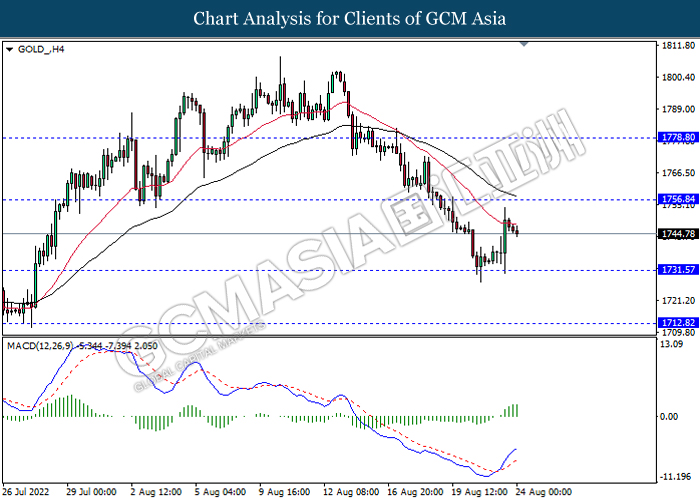

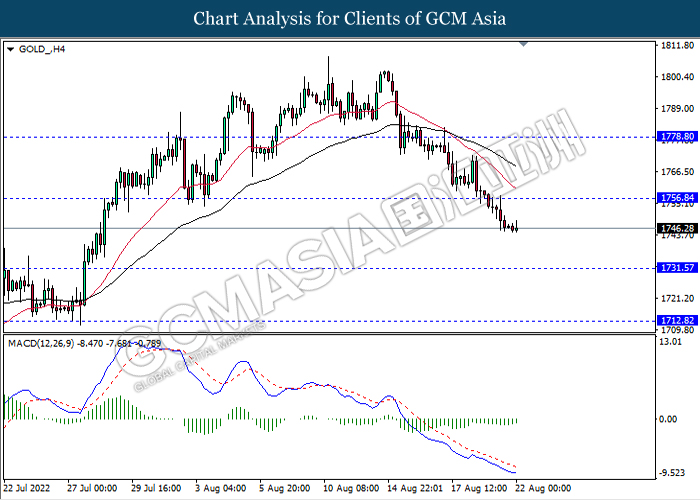

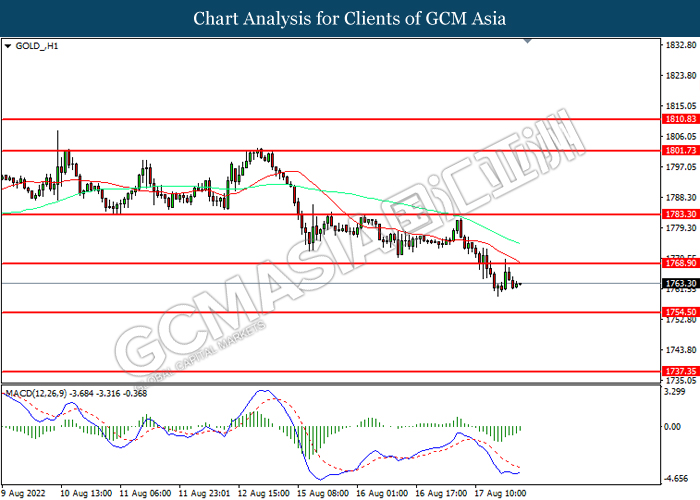

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80

260822 Morning Session Analysis

26 August 2022 Morning Session Analysis

Greenback revived as the US economy contracted mildly.

The dollar index, which gauges its value against a basket of six major currencies, regained its foot after experiencing some losses since the beginning of the week, as the US economy contracts milder than consensus expectation in the second quarter. According to the Bureau of Economic Analysis, the US GDP came in at -0.6%, missing the consensus forecast of -0.8%, mirroring that the economy shrank at a moderate pace in the second quarter. Consumer spending has eased some of the drag from a sharp slowdown in inventory accumulation, dispelling fears that the nation’s economy is heading toward recession. Besides, the upbeat employment data also urged investors to buy in the dollar index yesterday. According to the labour department, the US Initial Jobless Claims data came in at 243K, far lower than the consensus forecast at 253K, showing some sign of recovery in the labour market. However, the gains of the greenback were limited by the market concern over the speech of Jerome Powell on Friday, as the Federal Reserve Chairman is expected to provide some clues about the pace of the rate hike plan. At this point in time, the investors are wavering between the possibility of a 50 or 75 basis point hike in the September Fed meeting. With the backdrop of hawkish statements had been given by the Fed members, markets are expecting a hawkish message from Powell. As of writing, the dollar index dropped 0.24% to 108.40.

In the commodities market, the crude oil price was down by 0.09% to $92.95 a barrel amid a possible nuclear deal between the US and Iran, which would eventually be making Iranian oil to be allowed for exportation resumption to the world. Besides, the gold prices depreciated -0.10% to $1757.00 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Jul) | 0.6% | 0.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 108.50. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after its candle successfully closes below the support level.

Resistance level: 109.70, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1835. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6245.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the support level at 93.15. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 90.35.

Resistance level: 93.15, 96.00

Support level: 90.35, 87.85

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

250822 Afternoon Session Analysis

25 August 2022 Afternoon Session Analysis

Euro lingered as the nation economy clouded by rising gas price.

The EUR/USD, which traded by majority of investors, seesawed under 1.0000 level amid the spiking gas price. The price of natural gas used to reach $9.97 per cubic foot in recent time while it was adding pressures toward economic momentum in Europe. As Europe was one of the dependent on commodities products such as natural gas, the skyrocketed gas price would increase the costs in Europe region, which jeopardize the market outlook in Europe. Besides, Russian state energy firm Gazprom said Russia will pause natural gas supplies to Europe for three days through Nord Stream 1 due to unscheduled maintenance, suppressing the market optimism upon the prospects of Euro. As of now, the market participants would focus on the monetary policy meeting from ECB which scheduled tonight in order to gauge the likelihood movement of EUR/USD. As of writing, EUR/USD raised by 0.22% to 0.9987.

In the commodities market, the crude oil price appreciated by 0.48% to $95.34 per barrel as of writing following the US has sent its response to the European Union on a proposal to try to save the Iran nuclear deal. On the other hand, the gold price rose by 0.41% to $1755.85 per troy ounce as of writing over the value of US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Aug) | 88.6 | 86.8 | – |

| 20:30 | USD – GDP (QoQ) (Q2) | -0.9% | -0.8% | – |

| 20:30 | USD – Initial Jobless Claims | 250K | 253K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1820, 1.1895

Support level: 1.1740, 1.1660

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7090

Support level: 0.6930, 0.6865

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 97.90, 100.25

Support level: 94.45, 91.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80

250822 Morning Session Analysis

25 August 2022 Morning Session Analysis

Dollar standstill ahead of the GDP data.

The dollar index, which gauges its value against a basket of six major currencies, hovered near the recent high level as the investors are waiting for the announcement of the crucial data – GDP. In the past few months, the US GDP has continuously shown a negative figure, mirroring that the nation was teetering on brink of recession. With the rising concern of market participants over the recession risk, investors are eyeing the GDP data in order to gauge the ongoing economic condition of the US. Other than that, the investors are also waiting for a Friday Speech by Federal Reserve Chairman Jerome Powell for some clues on how aggressive the central bank will be in fighting against the sky-high inflationary pressures. After the majority of the Fed members revealed their hawkish stance toward the tightening path, investors have pared back expectation that the Fed would likely increase the interest rate aggressively, says a 75-basis point in the coming Fed meeting. According to the Fed Watch Tool, the possibility of a 75-basis point rate hike is now at 61.0%, up from the previous week’s 28.0%. As of writing, the dollar index dropped -0.02% to 108.60.

In the commodities market, the crude oil price was down by 0.18% to $95.20 a barrel as the US data showed crude inventory draw for the second consecutive week. According to the EIA, the US inventory data came in at -3.282M, while the consensus forecast was -0.933M. Besides, the gold prices appreciated by 0.01% to $1751.50 a troy ounce as market participants are waiting for the crucial GDP data to be released.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q2) | 0.2% | 0.0% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Aug) | 88.6 | 86.8 | – |

| 20:30 | USD – GDP (QoQ) (Q2) | -0.9% | -0.8% | – |

| 20:30 | USD – Initial Jobless Claims | 250K | 253K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 109.70.

Resistance level: 109.70, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1835. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6245.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2985. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2925.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 96.00.

Resistance level: 96.00, 98.20

Support level: 93.15, 90.35

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

240822 Afternoon Session Analysis

24 August 2022 Afternoon Session Analysis

Pound under pressure over soaring stagflation risk.

The GBP/USD, which well known by majority of investors received significant bullish momentum on yesterday amid the slip of US Dollar. Though, the overall trend of the pairing remained downward following the rising fears on UK’s economy. According to Reuters, the US bank Citi has forecasted that the British consumer price inflation would likely to reach a high level of 18.6% in January 2023. The spiking inflation would bring further side effect toward consumers and companies, which might lead to another serious stagflationary issue. The pessimistic economic outlook in UK has prompted investors to flee away from the UK market and seeking for other profitable assets. On the economic data front, a series of economic data such as UK Manufacturing Purchasing Managers Index (PMI) and UK Composite Purchasing Managers’ Index (PMI) has given a downbeat figures as well as Pound Sterling retreated from its prior gains. As of writing, GBP/USD depreciated by 0.21% to 1.1806.

In the commodities market, the crude oil price edged up by 0.01% to $93.75 per barrel as of writing. According to American Petroleum Institute, the US API Weekly Crude Oil Stock notched down from the previous reading of -0.448M to -5.632M, far away from the consensus expectation of -0.450M. Besides, that, the gold price dropped by 0.19% to $1744.75 per troy ounce as of writing ahead of Fed Chairman Jerome Powell speech in Jackson Hole Symposium.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jul) | 0.4% | 0.2% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jul) | -8.6% | -4.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -7.056M | -0.933M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1820, 1.1895

Support level: 1.1740, 1.1645

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6810

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 94.40, 97.90

Support level: 91.50, 87.95

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80

240822 Morning Session Analysis

24 August 2022 Morning Session Analysis

A series of downbeat data limited the gains of Greenback.

The dollar index, which gauges its value against a basket of six major currencies, failed to extend its gains yesterday as a series of data showed that US published downbeat figures. Late yesterday, the S&P Global Composite PMI was released with a weaker-than-expected figure, whereby the actual reading came in at 45.0, far lower than both the consensus forecast and prior reading at 49.0 and 47.7 respectively. The reduction in output was broad-based, with manufacturers and service providers registering lower activity. Diving deeper into the manufacturing sector, US Manufacturing PMI for the month of August came in at 51.3, lower than the consensus forecast at 52.0. On the other hand, the US service sector firms recorded a steeper rate of decline, whereby the August figure dropped from 47.3 to 44.1 while indicating the sector activity fell sharply month over month. The customer demand has significantly dampened mainly attributed to a few factors including material shortages, delivery delays, hikes in interest rates and strong inflationary pressures. The renewed contraction risk in the US urged the investors to flee away from the US dollar market and enter into some other market such as Pound and Euro. As of writing, the dollar index edged down 0.49% to 108.50.

In the commodities market, the crude oil price up 0.10% to $93.70 a barrel as Saudi Arabia floated the idea of OPEC+ may trim their oil production to support prices if the US were to remove the oil exportation sanction against Iranian. Besides, the gold prices up by 0.09% to $1746.40 a troy ounce following the release of downbeat data from the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jul) | 0.4% | 0.2% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jul) | -8.6% | -4.0% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 109.70.

Resistance level: 109.70, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1800. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1800, 1.1900

Support level: 1.1620, 1.1485

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6245. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2985. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully closes its candle below the support level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 93.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.15, 98.20

Support level: 90.35, 87.85

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1729.25. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

230822 Afternoon Session Analysis

23 August 2022 Afternoon Session Analysis

Euro dipped following bearish economy prospects in Eurozone.

The EUR/USD, which traded by majority of investors slumped on yesterday amid the raising concerns on Eurozone’s economy. According to Reuters, the Bundesbank has given its forecast that the recession in German would likely to increase and the inflation would continue to climb and reach more than 10% in this year, which increased the odds of stagflation risk faced by German. Besides, the European Central Bank emphasized that the high uncertainty of gas supply in winter month might add further pressure upon households and companies, indicating that the economic prospects in Eurozone remained stagnant. The pessimistic economy outlook in Eurozone has stoked a shift in sentiment toward other currencies which having better prospects. Meanwhile, Europe faces another disruption of energy supplies due to damage to a pipeline system bringing oil from Kazakhstan through Russia, suppressing the investors’ confident in Europe economic progression. As of writing, EUR/USD edged up by 0.03% to 0.9944.

In the commodities market, the crude oil price appreciated by 1.05% to $91.31 per barrel as of writing following the OPEC could diminish oil output in order to adjust recent drop in oil futures. On the other hand, the gold price rose by 0.16% to $1738.15 per troy ounce as of writing. Nonetheless, gold price dropped significantly on yesterday trading session over the appreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Aug) | 49.3 | 48.2 | – |

| 16:30 | GBP – Composite PMI | 52.1 | 51.3 | – |

| 16:30 | GBP – Manufacturing PMI | 52.1 | 51.0 | – |

| 16:30 | GBP – Services PMI | 52.6 | 52.0 | – |

| 22:00 | USD – New Home Sales (Jul) | 590K | 575K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1820, 1.1895

Support level: 1.1740, 1.1645

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6810

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.40

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80

230822 Morning Session Analysis

23 August 2022 Morning Session Analysis

Dollar jumped amid the hawkish Fed tone.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its gains yesterday, hitting its highest level in six weeks amid the hawkish comments from the Fed Officials. Over the weekend, Fed’ member Thomas Barkin revealed that the tightening path of the Fed unlikely to change at the moment as their target was to cool down the sky-high inflationary pressures in the US economy. With that, the investors bet on larger rate hike, says 75-basis point, in the September Fed’s meeting, prompting the investors to shift their holdings away from the other currency market toward the dollar market. At this moment, majority of the investors are waiting for the central bank’s key Jackson Hole symposium later this week in order to gauge the further direction of the currency. This is because Jerome Powell is expected to give his long-waited stance on the recent drop in inflation figure as well as the future direction of the monetary policy. As of writing, the dollar index surged 0.73% to 108.95.

In the commodities market, the crude oil price up 0.10% to $91.55 a barrel after Saudi Energy Minister Prince Abdulaziz bin Salman warned that OPEC+ could cut output to deal with challenges. Besides, the gold prices extended its losses by 0.03% to $1735.70 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Aug) | 49.3 | 48.2 | – |

| 16:30 | GBP – Composite PMI | 52.1 | 51.3 | – |

| 16:30 | GBP – Manufacturing PMI | 52.1 | 51.0 | – |

| 16:30 | GBP – Services PMI | 52.6 | 52.0 | – |

| 22:00 | USD – New Home Sales (Jul) | 590K | 575K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.50, 109.65

Support level: 107.85, 107.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1800. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6245. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6140.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3050. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully close its candle above the resistance level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the downward trendline.

Resistance level: 93.15, 98.20

Support level: 90.35, 87.85

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1729.25. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

220822 Afternoon Session Analysis

22 August 2022 Afternoon Session Analysis

Aussie dived amid China economic clouded by power rationing.

The AUD/USD, which traded by majority of investors dropped significantly on last Friday over the pessimistic economic outlook in China, which spurred bearish momentum on the Aussie. According to Reuters, one of the largest city in China, Sichuan, has extended power rationing across the region amid extreme heat and drought. The power rationing has caused the factories and industrials remained closed until 25 August, which would likely to add further pressure on the economic progression in China. Thus, it would also brought negative prospects toward Australia’s economy as China was the largest trading partner for Australia. Besides that, the losses of Aussie was extended following the Fed’s member has appeared their hawkish statement recently, leading investors to flee away from the risk-appetite market and purchase US Dollar. As of writing, AUD/USD appreciated by 0.36% to 0.6897.

In the commodities market, the crude oil price depreciated by 1.01% to $89.55 per barrel as of writing. According to the source, Iran and Western countries were close to striking a deal that would lift sanctions on the oil supply. On the other hand, the gold price eased by 0.14% to $1747.20 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1895, 1.1990

Support level: 1.1820, 1.1740

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0075, 1.0160

Support level: 1.0005, 0.9935

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6810

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9595, 0.9680

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.40

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80

220822 Morning Session Analysis

22 August 2022 Morning Session Analysis

Dollar surged amid positive Fed rate hike forecast.

The dollar index, which gauges its value against a basket of six major currencies, extended its gains over the last Friday trading session as investors reckon that the Federal Reserve will keep raising the interest rates to cool down the overheating economy going forward. Following the release of the Fed’s meeting minutes, the likelihood of an upcoming Fed 75 basis point rate hike has increased from 31% to 47% as the Fed officials are seemingly more aggressive than the investor’s expectation. On the other side, Fed’s Barkin said that the Fed will do what it takes to return inflation to the long-term target of 2%. Besides, he also emphasized that the decline in the recent inflation figure was mainly due to volatile items, signalling that the overall inflationary pressures did not ease in a ‘healthy’ way in fact. At this point in time, the Fed is seen as having ample room for further rate hikes than other central banks which are more fragile. Nonetheless, the tightening path of the Federal Reserve would still be depended on the future economic condition in the US, where more rate hikes could be seen if the nation’s economy continues to suffer sky-high inflationary pressures. As of writing, the dollar index dropped -0.06% to 108.10.

In the commodities market, the crude oil price is down -0.39% to $89.35 a barrel after rising more than $3 per barrel as lacking positive news on the Iran-US nuclear deal issue. Besides, the gold prices depreciated by -0.02% to $1747.00 a troy ounce amid the dollar’s strengthening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.85. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.85, 108.50

Support level: 107.15, 105.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1800. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

EURUSD, Daily: EURUSD was traded lower following prior breakout below the support level at 1.0075. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0000.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6245. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6140.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2985. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3050.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 90.35. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 87.85.

Resistance level: 90.35, 93.15

Support level: 87.85, 85.30

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

190822 Afternoon Session Analysis

19 August 2022 Afternoon Session Analysis

Pessimistic economic outlook in China, spurred bearish momentum on China-proxy Aussie.

The China-proxy currencies such as Australia Dollar slumped significantly as the liquidity strain in the China property sector had sparked further recession risk concerns toward the global economic progression. According to CNBC, Chinese property developers’ cash flow had shrunken this year following steady growth over the last decade. The developer cash flow through July are down by 24% year-on-year on an annualized basis. In addition, the late mortgage payments to the developer had also added further constraints toward the source of cash flow. Analysts estimate property and industries related to real estate account for more than a quarter of China’s GDP. The real estate slump would contribute to further slowdown in economic growth this year. On the other hand, the Australia Dollar extend its losses over the backdrop of downbeat economic data. According to Australian Bureau of Statistics, Australia Employment Change came in at -40.9K, missing the market forecast at 25.0K. As of writing, AUD/USD depreciated by 0.10% to 0.6910.

In the commodities price, the crude oil price extends its surged 0.01% to $89.80 barrel per day. The crude oil price was edged higher yesterday following US released their upbeat economic data, which spurring positive prospect toward the oil demand. On the other hand, the gold price depreciated by 0.13% to $1756.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM)(Jul) | -0.1% | -0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM)(Jun) | 1.9% | 0.9% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 108.15, 109.10

Support level: 107.15, 106.55

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2025, 1.2125

Support level: 1.1915, 1.1820

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0155, 1.0285

Support level: 1.0080, 1.000

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 137.30, 139.10

Support level: 135.30, 132.40

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6990, 0.7120

Support level: 0.6895, 0.6805

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6340, 0.6455

Support level: 0.6225, 0.6070

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2955, 1.3105

Support level: 1.2755, 1.2645

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 91.70, 94.60

Support level: 88.95, 86.05

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1768.90, 1783.30

Support level: 1754.50, 1737.35

190822 Morning Session Analysis

19 August 2022 Morning Session Analysis

Dollar buoyed following the hawkish stance from Fed officials.

The dollar index, which gauges its value against a basket of six major currencies, surged as the members of the Federal Reserve (Fed) spoke of the need for further rate hikes. Early today, although Kansas City Federal Reserve President Esther George did not provide any clear stance on whether a 75-basis point of a rate hike is favourable, she did reveal that the drop in inflation registered in July, was great news. However, she emphasized that it was not good evidence the underlying problem was fixed, which hinted that the aggressive rate hike would not stop at the moment. Besides, St. Louis Fed President Jim Bullard has vowed that he sees about an 18-month process of getting inflation back to the Fed’s 2% target while reiterating his point of view that the inflation surge was not peaked yet. With that, he is leaning toward a 0.75% rate hike in the September meeting. On the data front, a series of positive economic data prompted the investors to shift their capital toward the dollar market. According to the labour department, US Initial Jobless Claims data came in at 250K, lower than the consensus forecast at 265K, indicating that the US labour market remains tight. Last but not least, the Philadelphia Fed Manufacturing Index (Aug) which was used to gauge the manufacturing activity in the region for August turned the table from the prior reading of -12.3 to 6.2, as the firms reported that the input price pressures eased. As of writing, the dollar index climbed 0.86% to 107.50.

In the commodities market, the crude oil price rose 3.62% to $91.05 a barrel as positive U.S. economic data and the nuclear deal remains silent offset the market concerns that slowing economic growth in other countries could undercut demand. Besides, the gold prices depreciated by -0.02% to $1758.00 a troy ounce amid the dollar’s weakening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM)(Jul) | -0.1% | -0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM)(Jun) | 1.9% | 0.9% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2035. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2035, 1.2175

Support level: 1.1900, 1.1800

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0075. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 0.9990

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6245. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2925. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9520. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.70. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 93.15.

Resistance level: 93.15, 98.20

Support level: 89.70, 87.30

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

180822 Afternoon Session Analysis

18 August 2022 Afternoon Session Analysis

Pound slumped as stagflation risk buoyed.

The Pound Sterling retreated from its higher-level following UK inflation rate hit record high, spurring further negative prospect toward economic momentum in the UK region. Though, investors would focus more on the monetary policy decision from Bank of England recently to receive further trading signal. According to Office for National Statistics, the UK Consumer Price Index (CPI) roses by 10.1% in the year of July, up from a reading of 9.4% in June while exceeding the market forecast at 9.80%. The UK inflation has risen above 10% for the first time in 40 years, driven by soaring prices for good and fuel as households come under mounting pressure from cost-of-living crisis. Economists warned that soaring inflation rate would hit poorer families hardest, dialled down the market optimism toward the overall economic progression in the United Kingdom. Nonetheless, the losses experienced by the Pound Sterling was limited by the hawkish expectation from Bank of England in future. Several analysts warned that the Bank of England would now like increase their interest rates further – with financial market expecting them to more than double to 3.75%, adding further pressure on the economic progression in UK. As for now, investors would still continue to focus on further monetary policy statement from Bank of England to receive further trading signal. As of writing, the pair of GBP/USD up 0.03% to 1.2050.

In the commodities market, the crude oil price rose 0.91% to $87.65 a barrel as Iran seeks assurances if the U.S. withdraws from a pact again, where the uncertainty heightened. Besides, the gold prices depreciated by -0.10% to $1765.00 a troy ounce following the release of hawkish bias meeting minutes from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.90% | 8.90% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 265K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Aug) | -12.3 | -5 | – |

| 22:00 | USD – Existing Home Sales (Jul) | 5.12M | 4.88M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6360. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6245.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2925. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9520. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 87.30. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 87.30, 89.70

Support level: 84.00, 79.65

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

180822 Morning Session Analysis

18 August 2022 Morning Session Analysis

Rate hike expectation from Fed, spurred bullish momentum on the Greenback.

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of hawkish tone from the Federal Reserve. According to the latest monetary policy meeting minutes, the Federal Reserve officials indicated that they would likely to maintain their rate hike decision until inflation rate calm down substantially. “With the inflation rate remaining well exceed to the Monetary Policy Committee (MPC) objective, they claimed that the restrictive stance of monetary policy was still required to meet the Committee’s inflation target to promote maximum employment and price stability”, according to the FOMC meeting minutes. Though, they did not provide specific guidance for future rate hike decision while reiterating that they would be scrutinizing the economic data closely before making that decision. As of writing, the Dollar Index appreciated by 0.16% to 106.70.

In the commodities market, the crude oil price rebounded by 0.35% to $87.25 per barrel as of writing following the upbeat inventory data was released. According to Energy Information Administration (EIA), the US Crude Oil Inventories came in at -7.056M, well below the market expectation at -0.275M. On the other hand, the gold price slumped 0.01% to $1762.90 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.90% | 8.90% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 265K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Aug) | -12.3 | -5 | – |

| 22:00 | USD – Existing Home Sales (Jul) | 5.12M | 4.88M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.55, 107.15

Support level: 105.55, 104.40

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2125, 1.2185

Support level: 1.2055, 1.1975

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6990, 0.7120

Support level: 0.6895, 0.6805

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6340, 0.6455

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9515, 0.9635

Support level: 0.9410, 0.9305

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 87.80, 91.70

Support level: 84.10, 79.05

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1768.90, 1783.30

Support level: 1754.50, 1737.35