270722 Afternoon Session Analysis

27 July 2022 Afternoon Session Analysis

Euro slumped upon heightening energy crisis risk.

The EUR/USD which traded by majority of investors dropped significantly on yesterday trading session amid the rising concerns upon energy supply shortage in European. According to Reuters, EU energy commissioner Kadri Simson claimed on Tuesday that Europe would face a massive supply gap if Russia fully cuts off gas supply through Nord Stream 1 in July. Besides, she reiterated that 15% of gas usage in Europe was reduced in order to preserve supplies in case of a slowdown in Russian gas inflows. The shortage of gas supplies would bring negative prospects toward economic progression in Europe it was one of the largest dependent on commodities. In addition, US Dollar surged following the IMF lowered its global growth forecast again on Tuesday, which causing Euro extended its losses. The growth cut from a prediction in April of 3.6% to 3.2% in 2022 as well as 2023 growth forecast lowered to 2.9% from the April estimate of 3.6%. The pessimistic economic outlook had prompted investors to shift their capitals toward safe-haven assets such as US Dollar. As of writing, EUR/USD appreciated by 0.31% to 1.0145.

In the commodities market, the crude oil price depreciated by 0.04% to 94.95 per barrel as of writing over the soaring concerns on global economic downturn. On the other hand, the gold price eased by 0.15% to 1715.45 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Statement

(28th July)

02:00 USD FOMC Press Conference

(28th July)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.7% | 0.2% | – |

| 22:30 | USD – Pending Home Sales (MoM) (Jun) | 0.7% | -1.5% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.466M | -1.037M | – |

| 02:00

(28thJuly)

|

USD – Fed Interest Rate Decision | 1.75% | 2.50% | – |

Technical Analysis

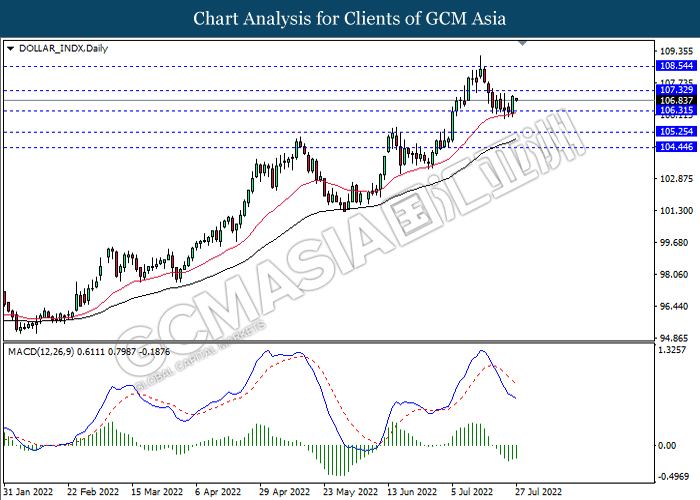

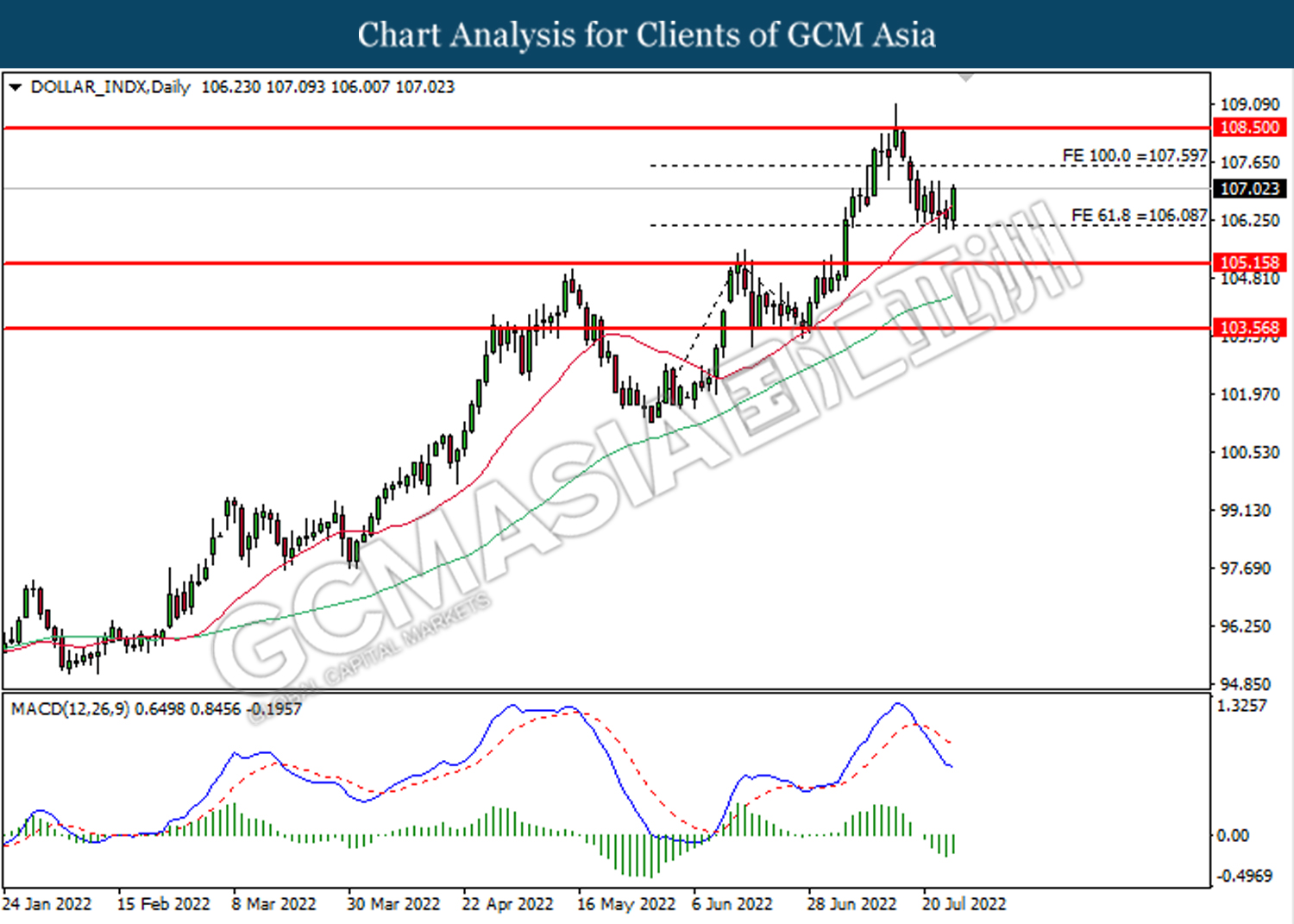

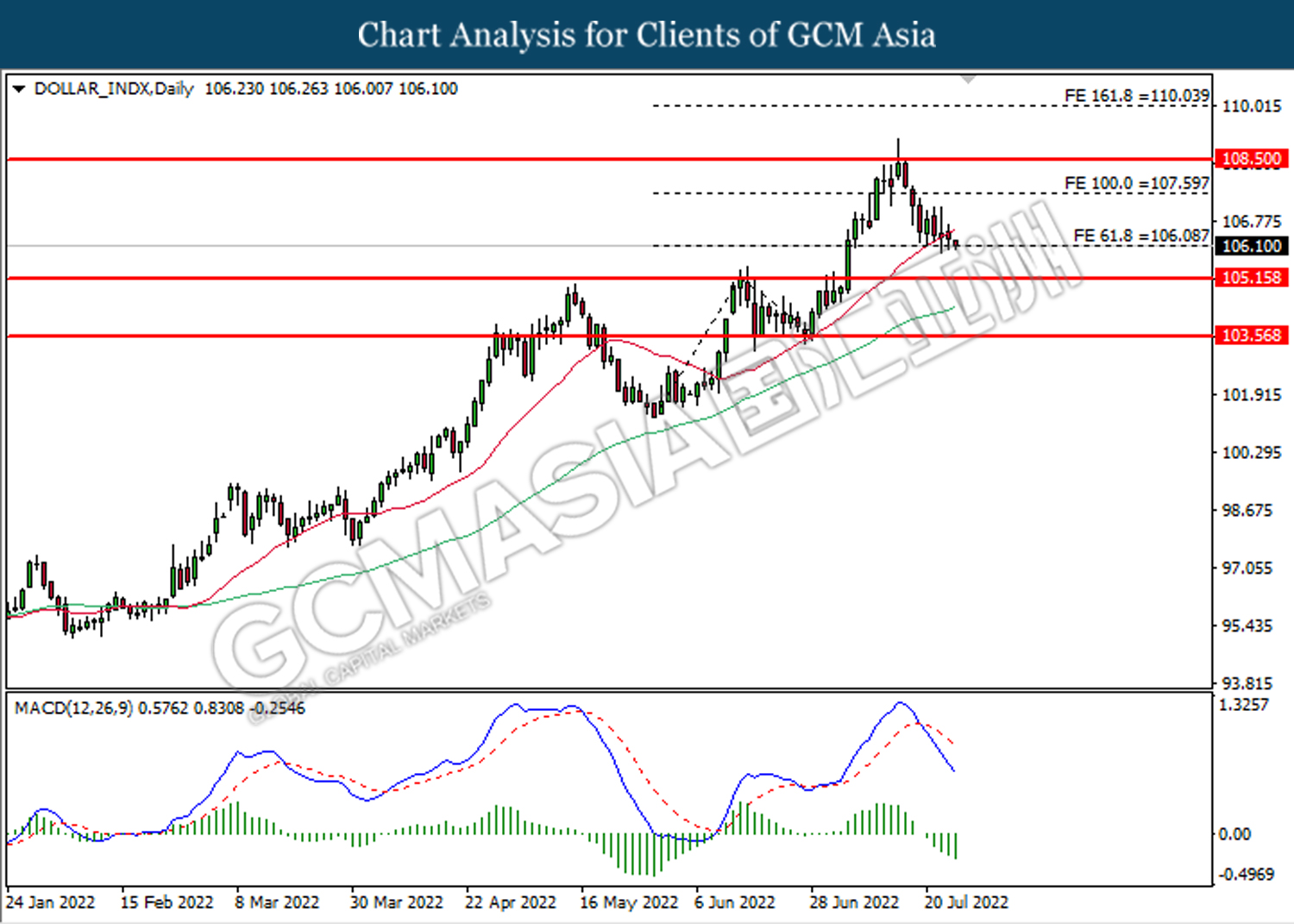

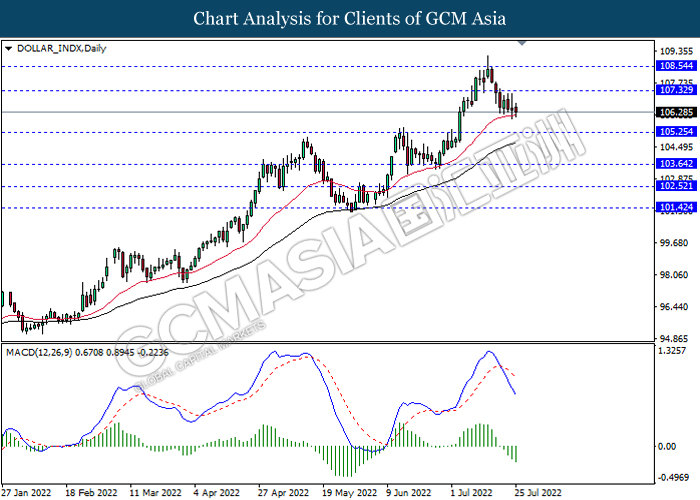

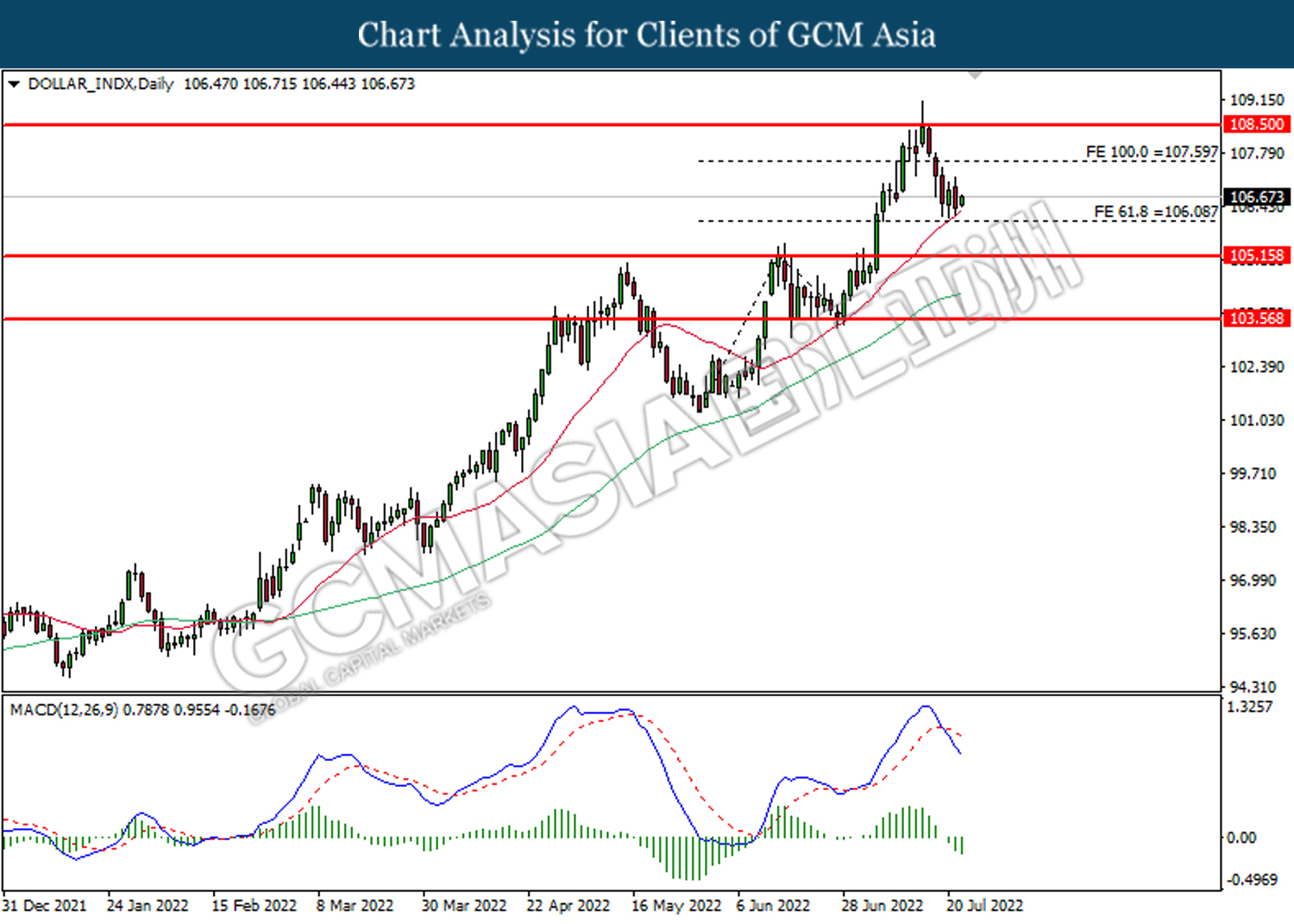

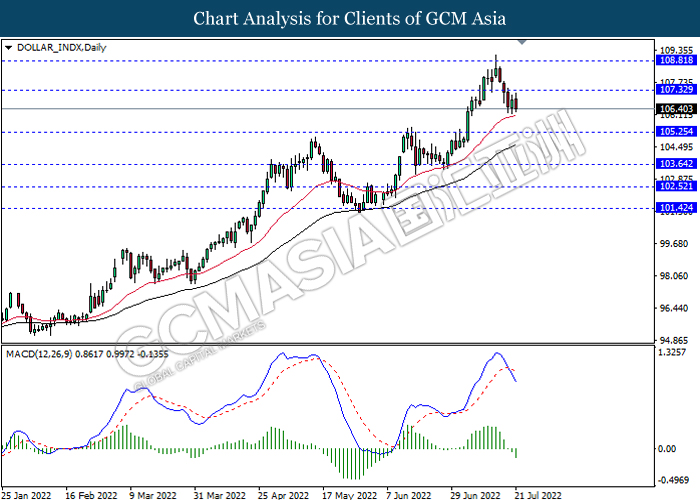

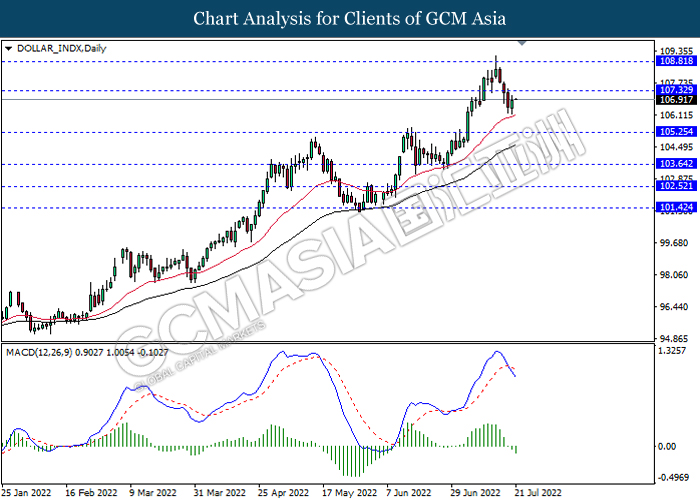

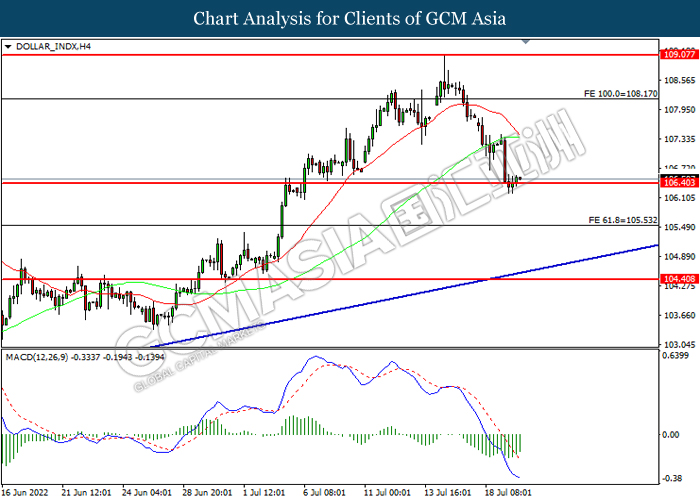

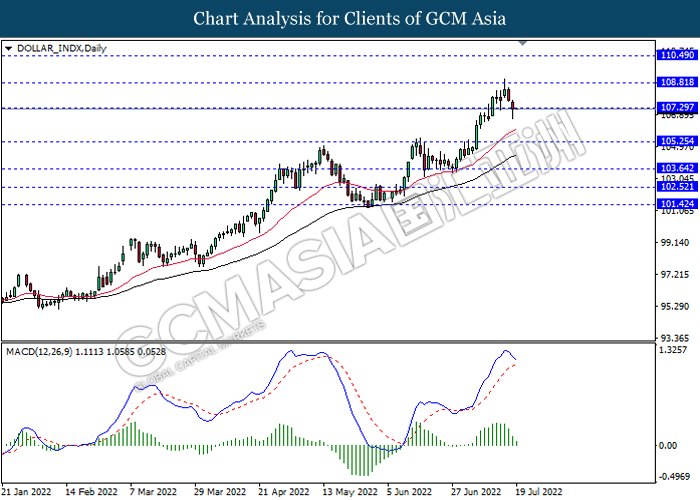

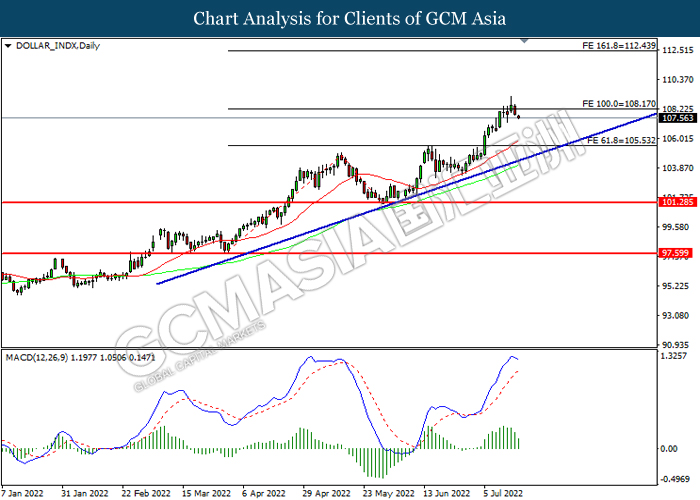

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 107.30, 108.55

Support level: 106.30, 105.25

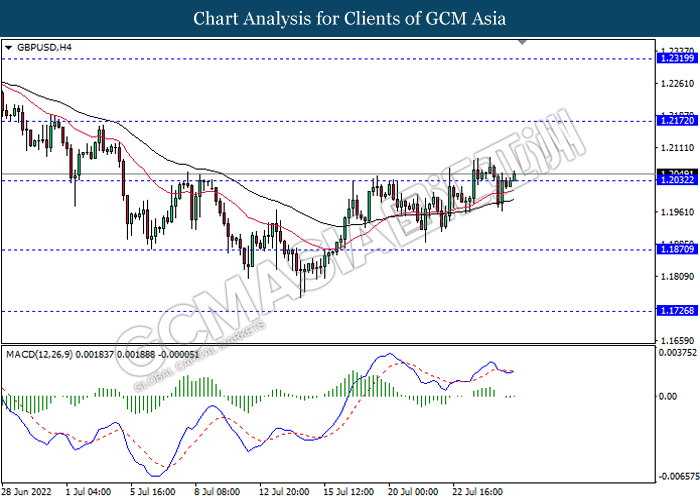

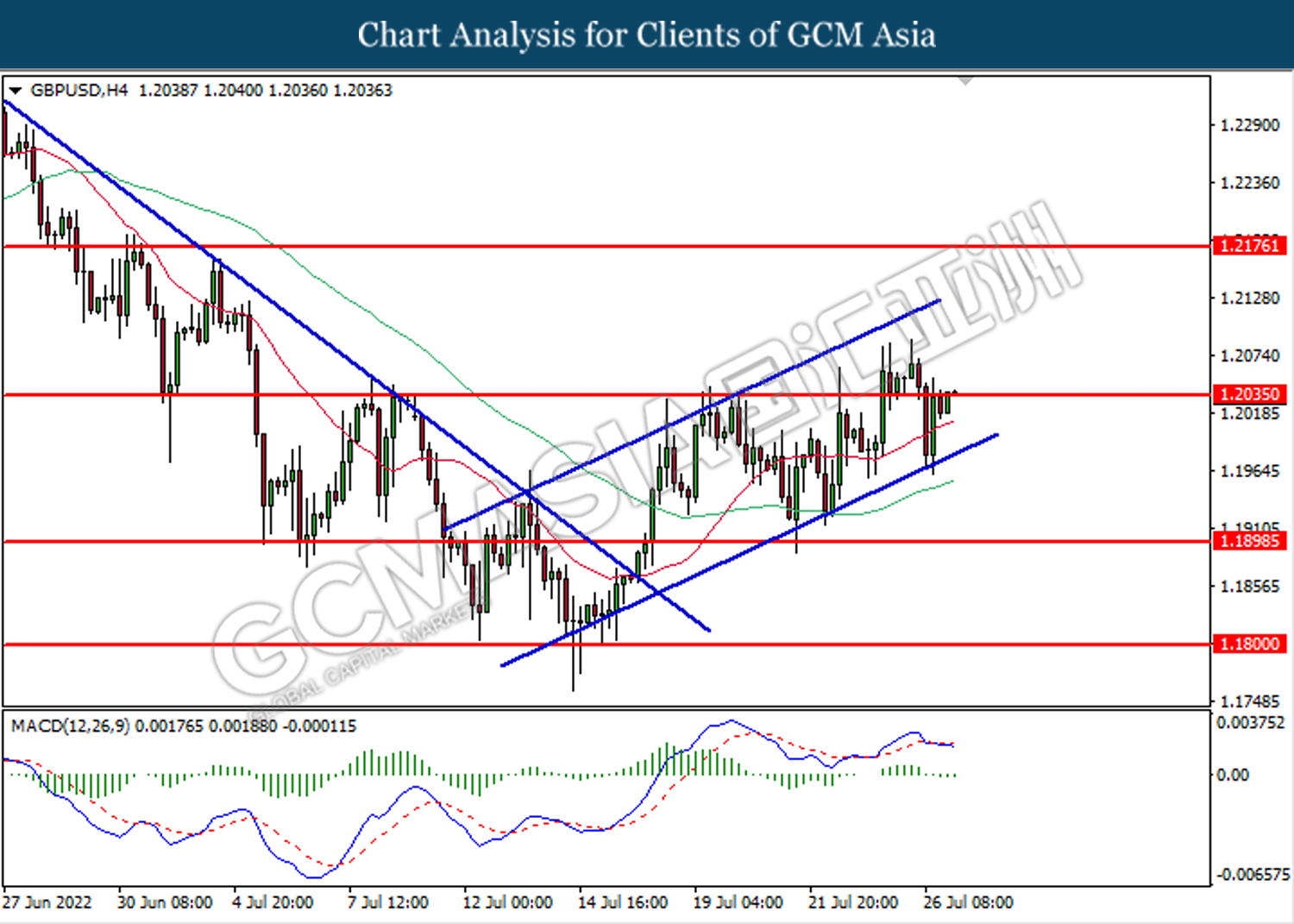

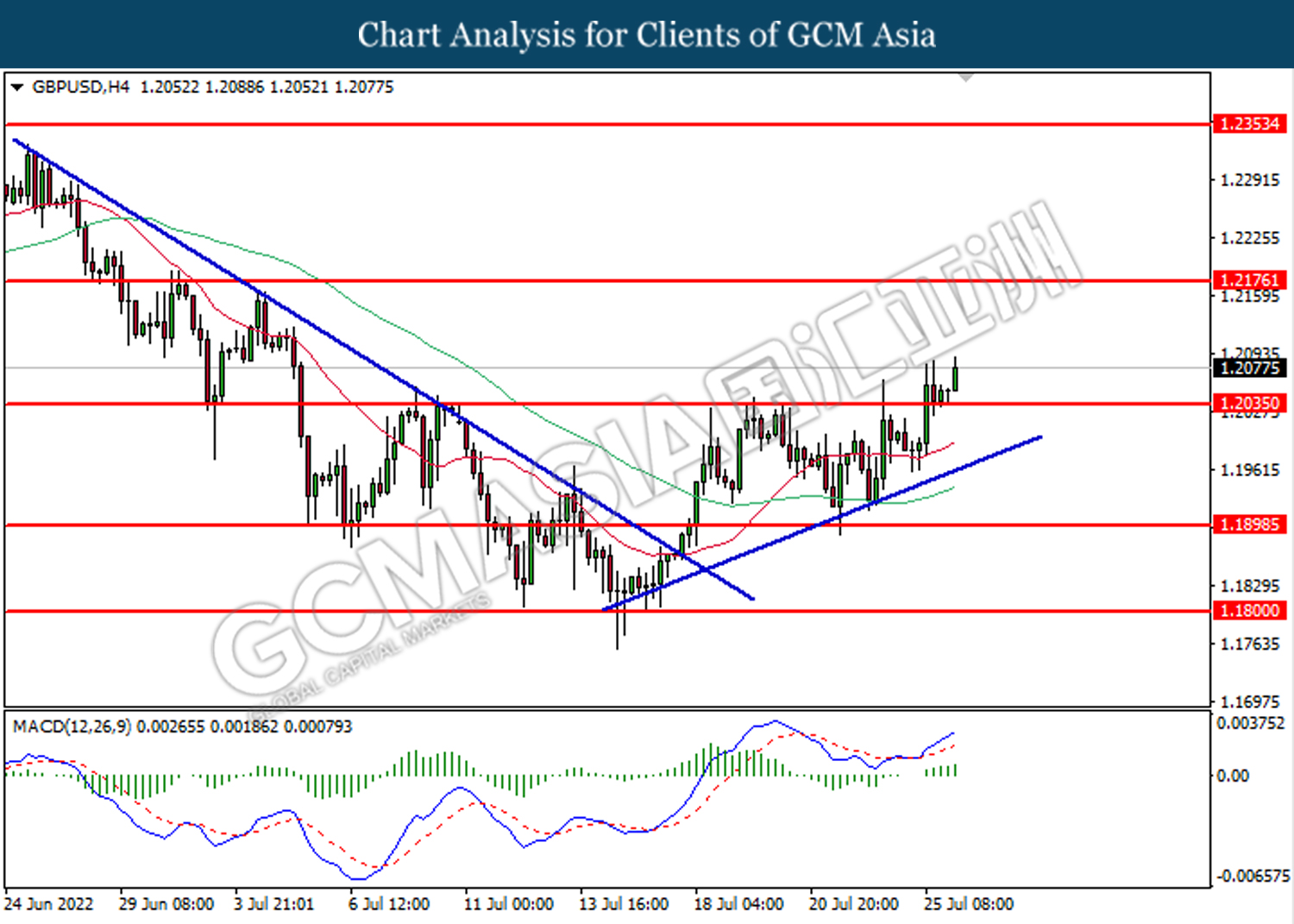

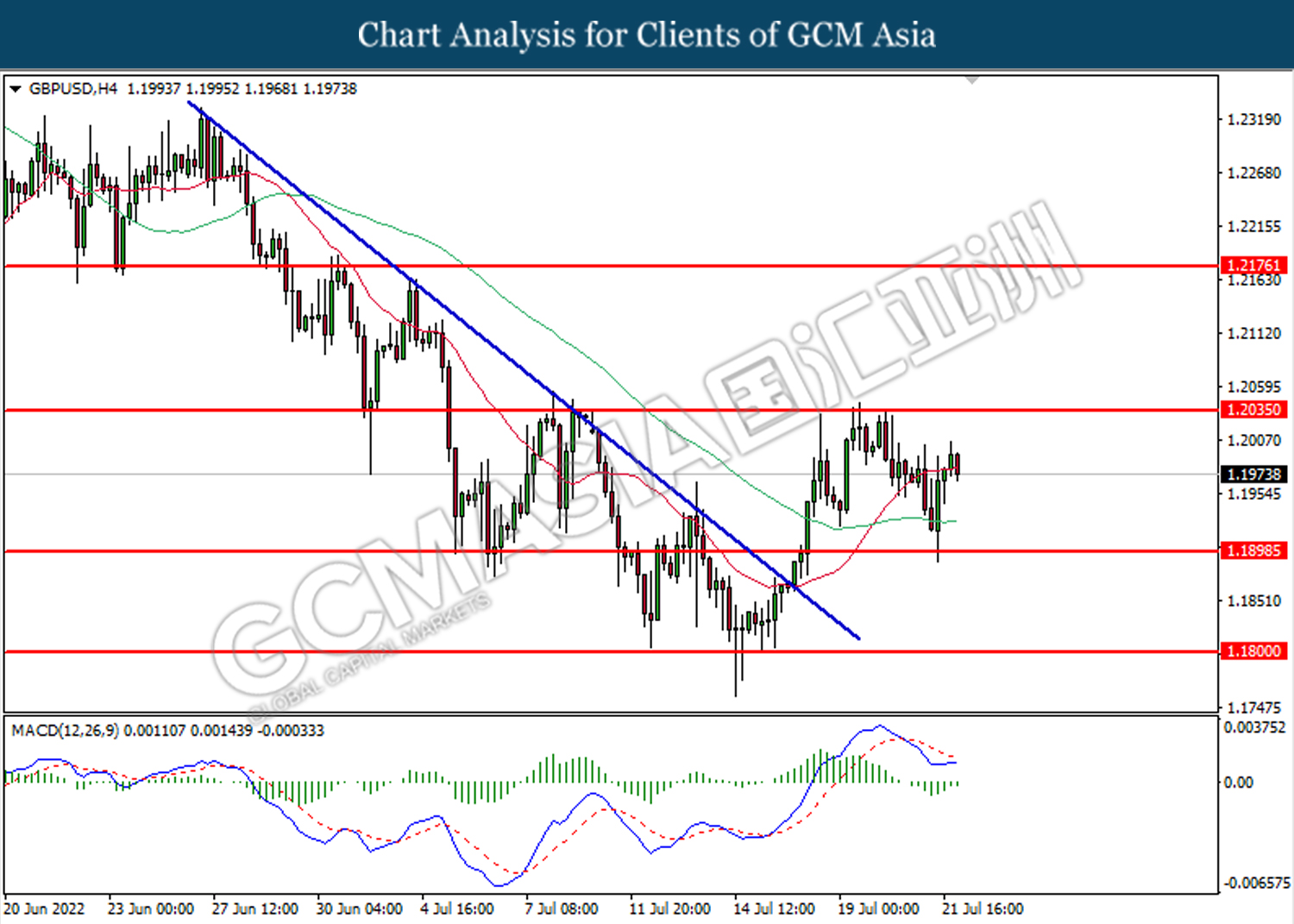

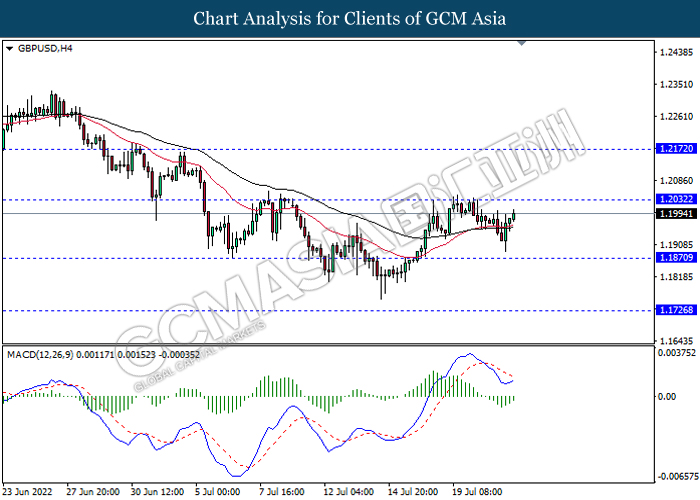

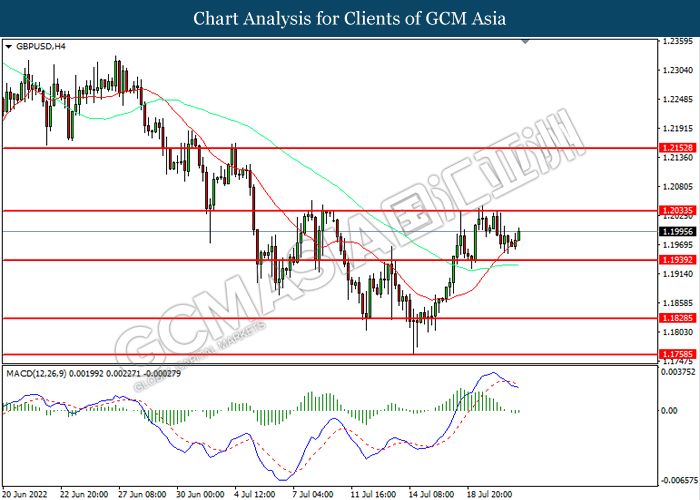

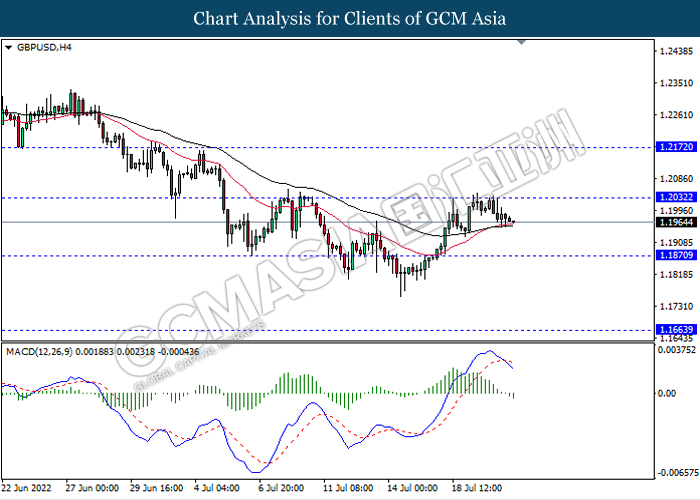

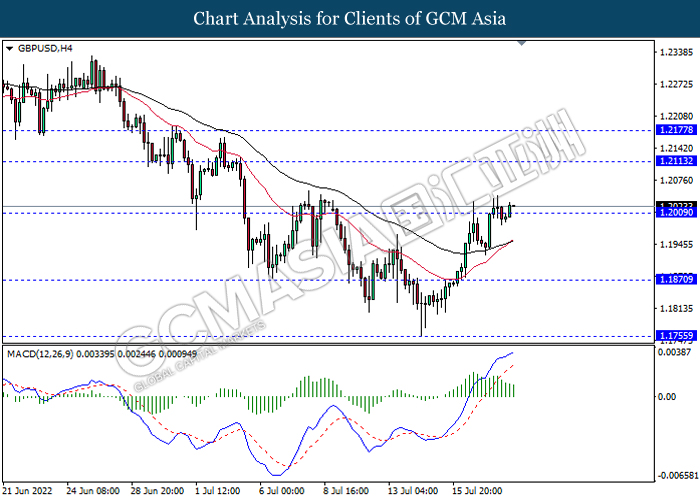

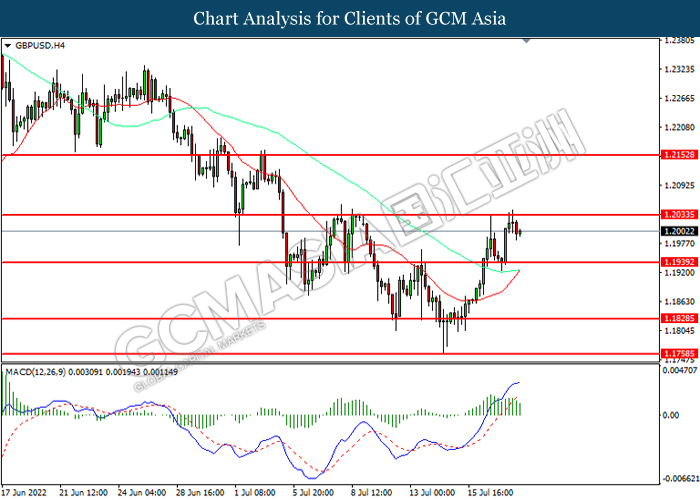

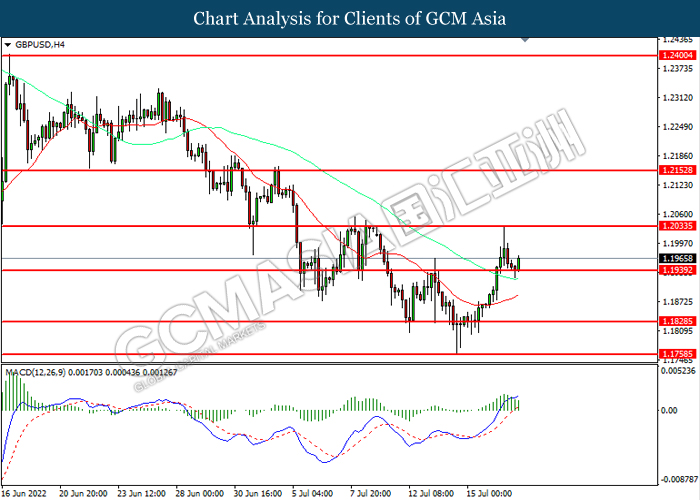

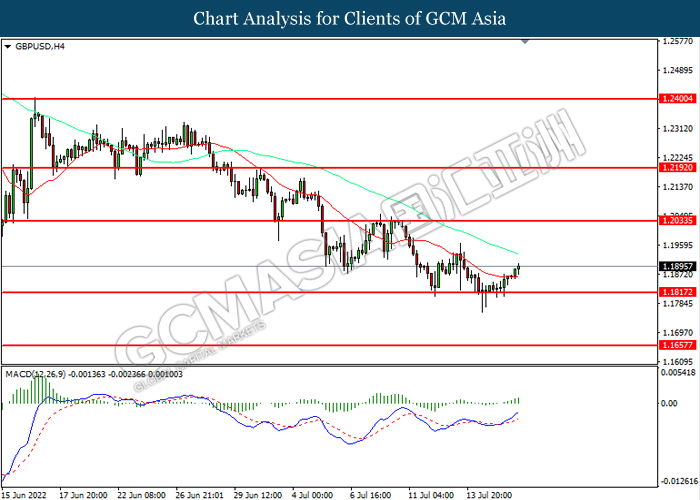

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

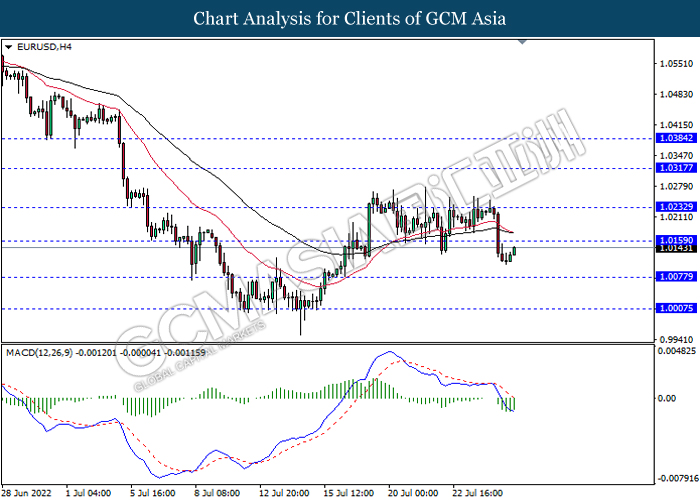

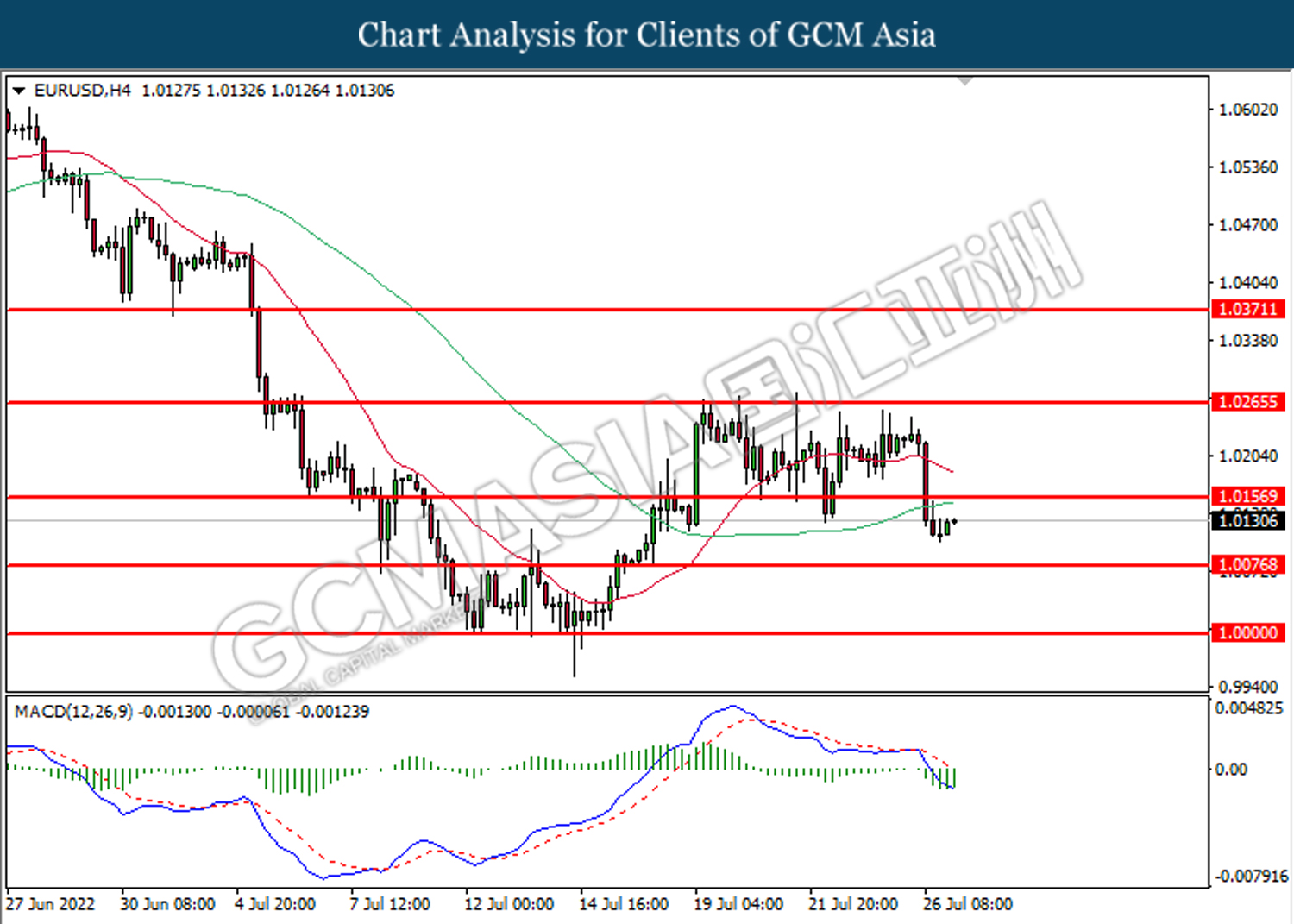

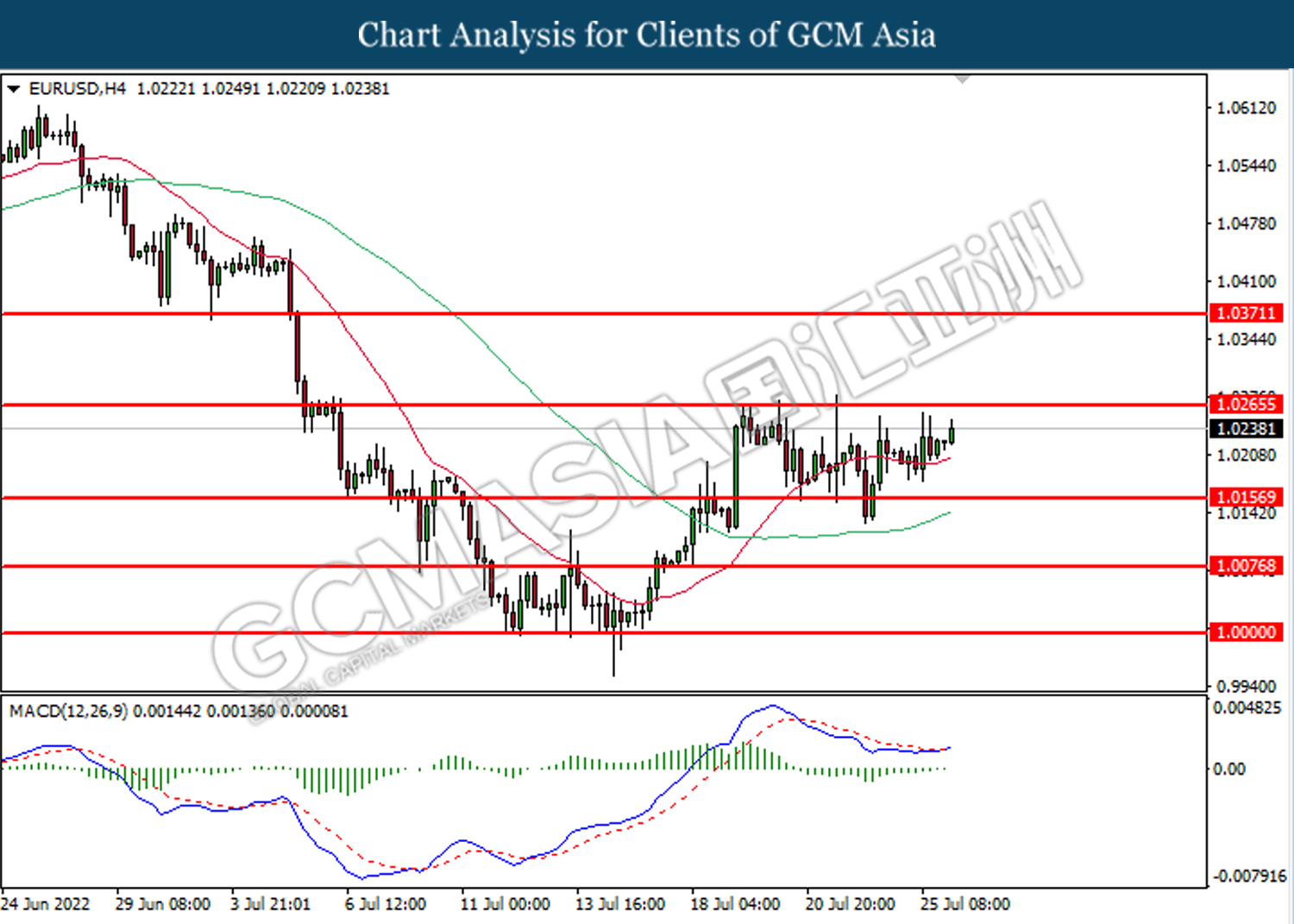

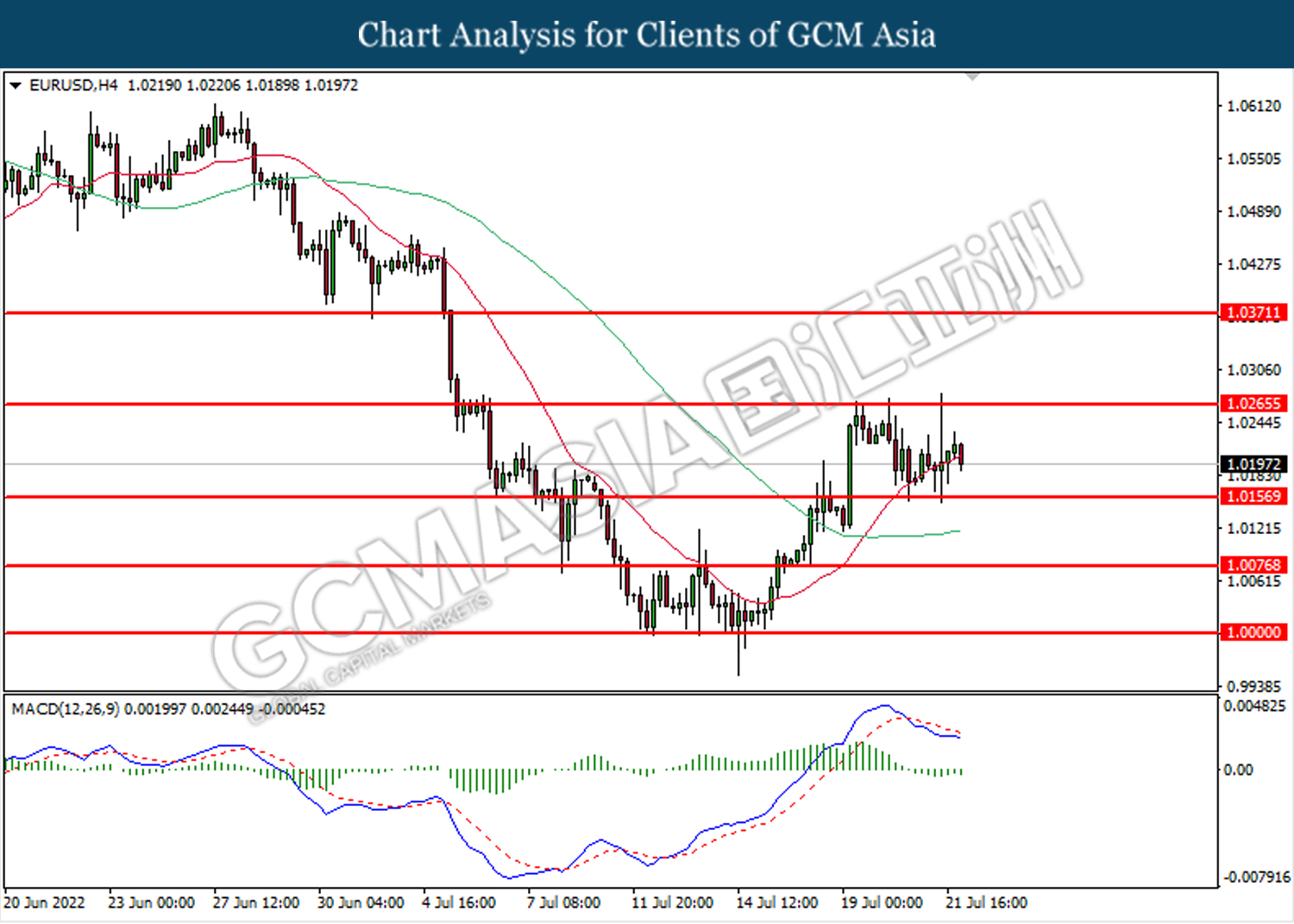

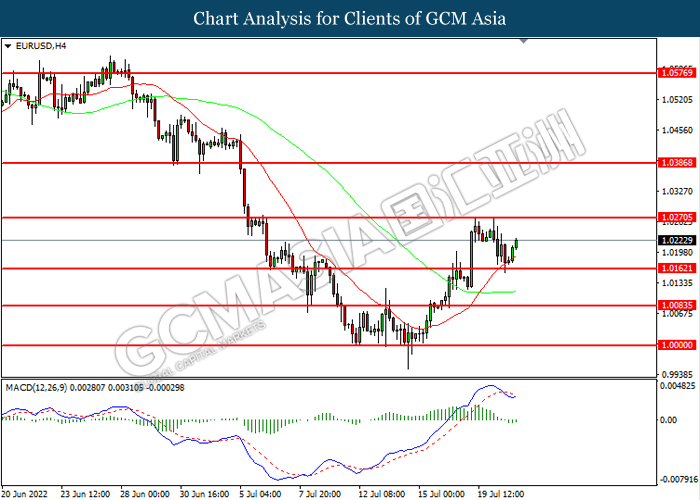

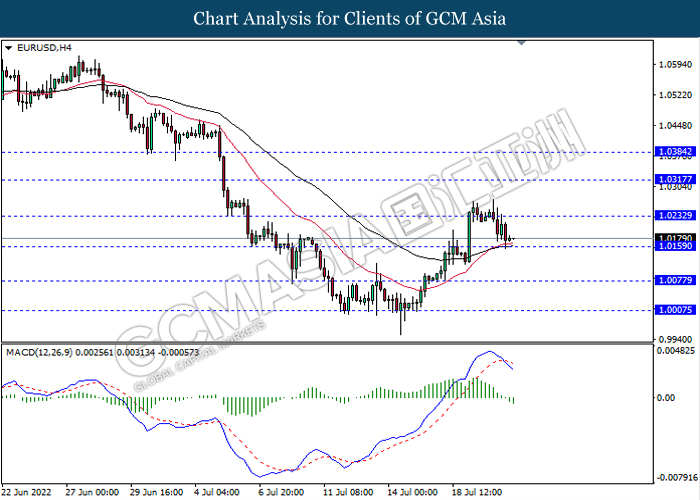

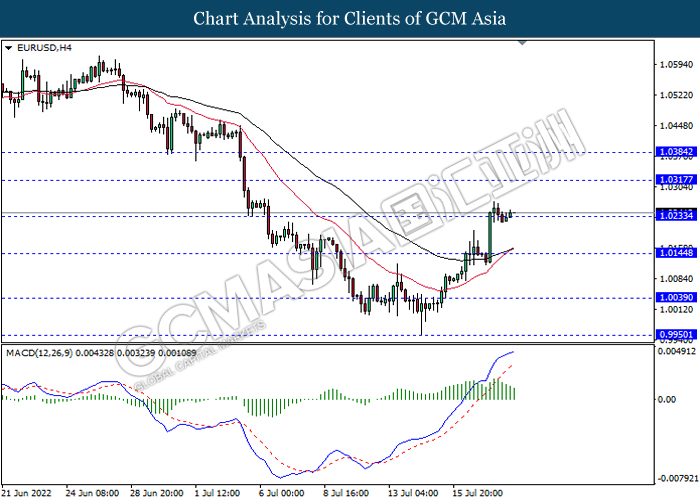

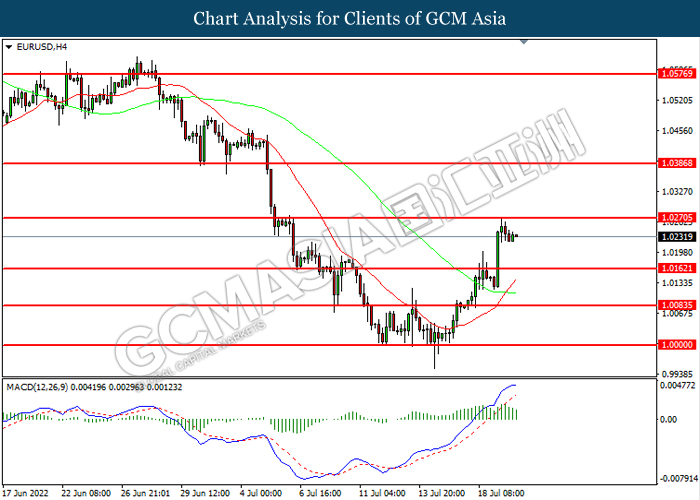

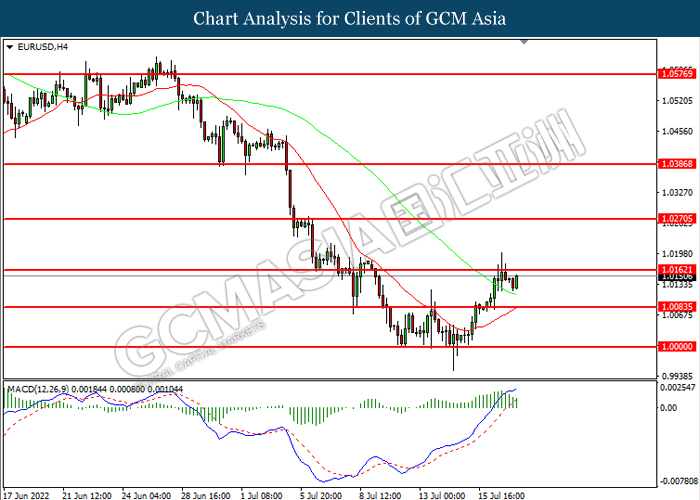

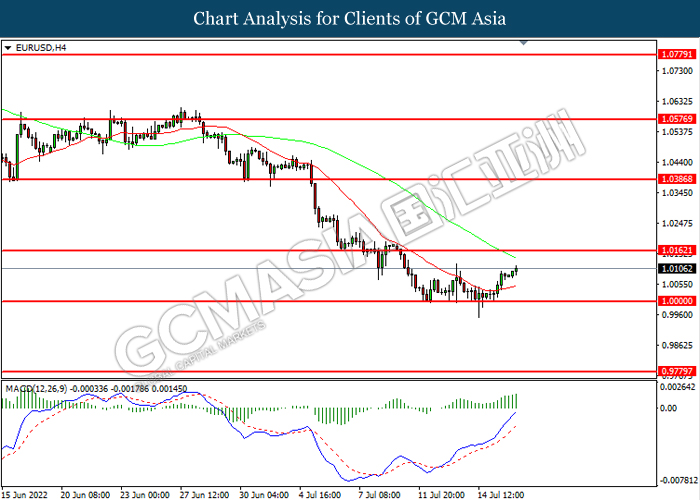

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0160, 1.0230

Support level: 1.0075, 1.0005

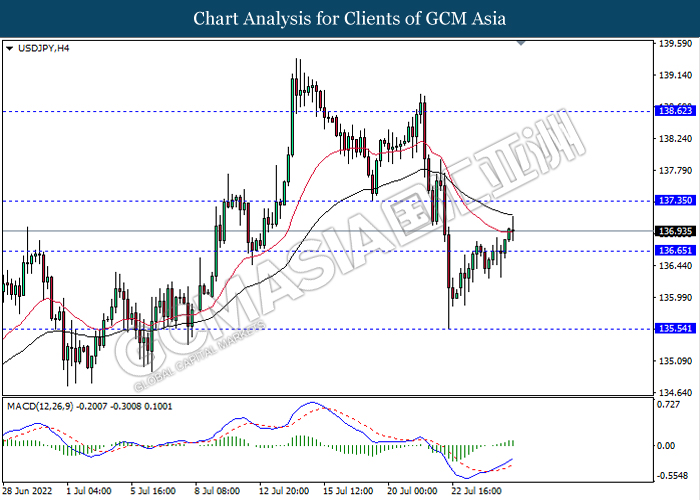

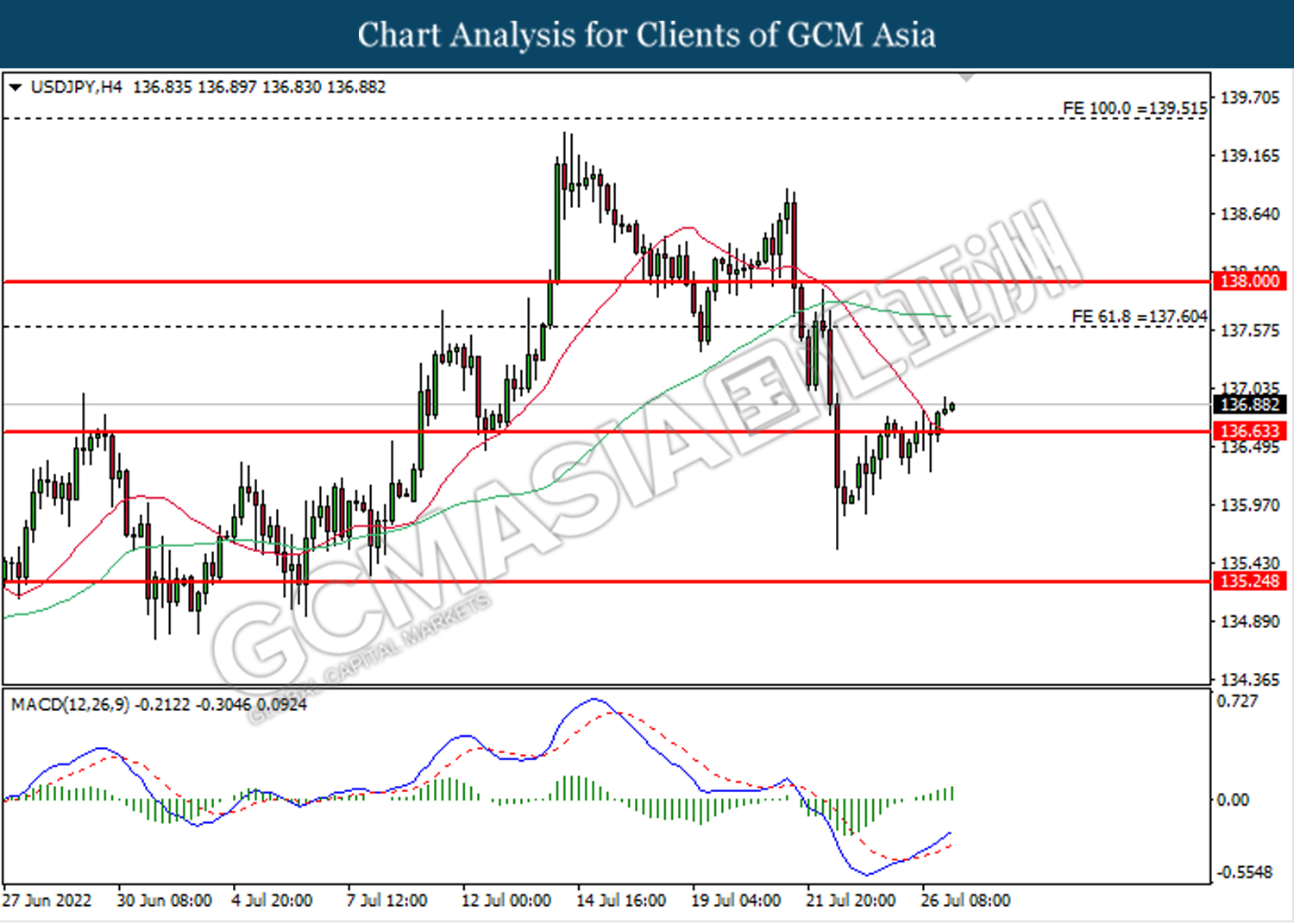

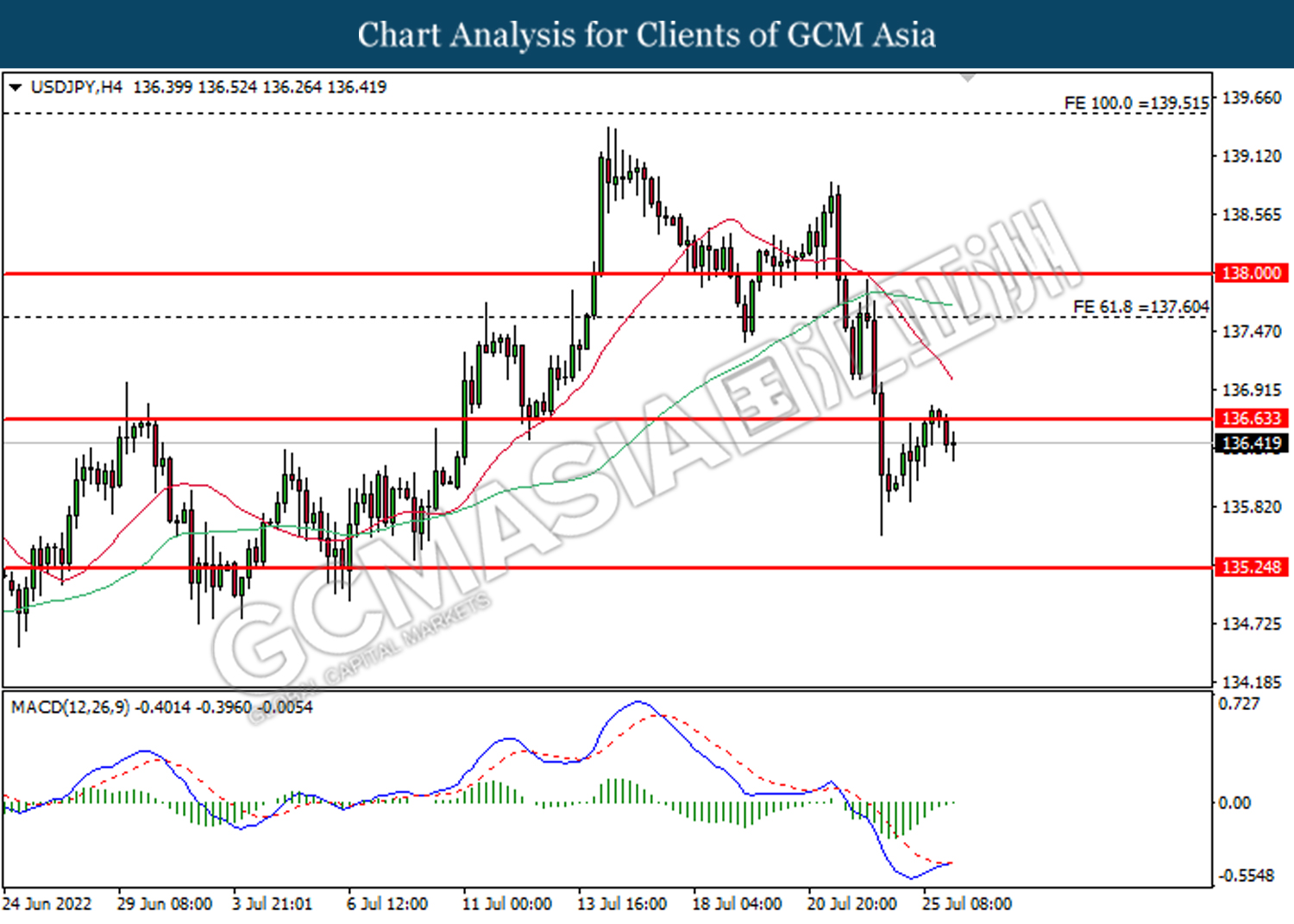

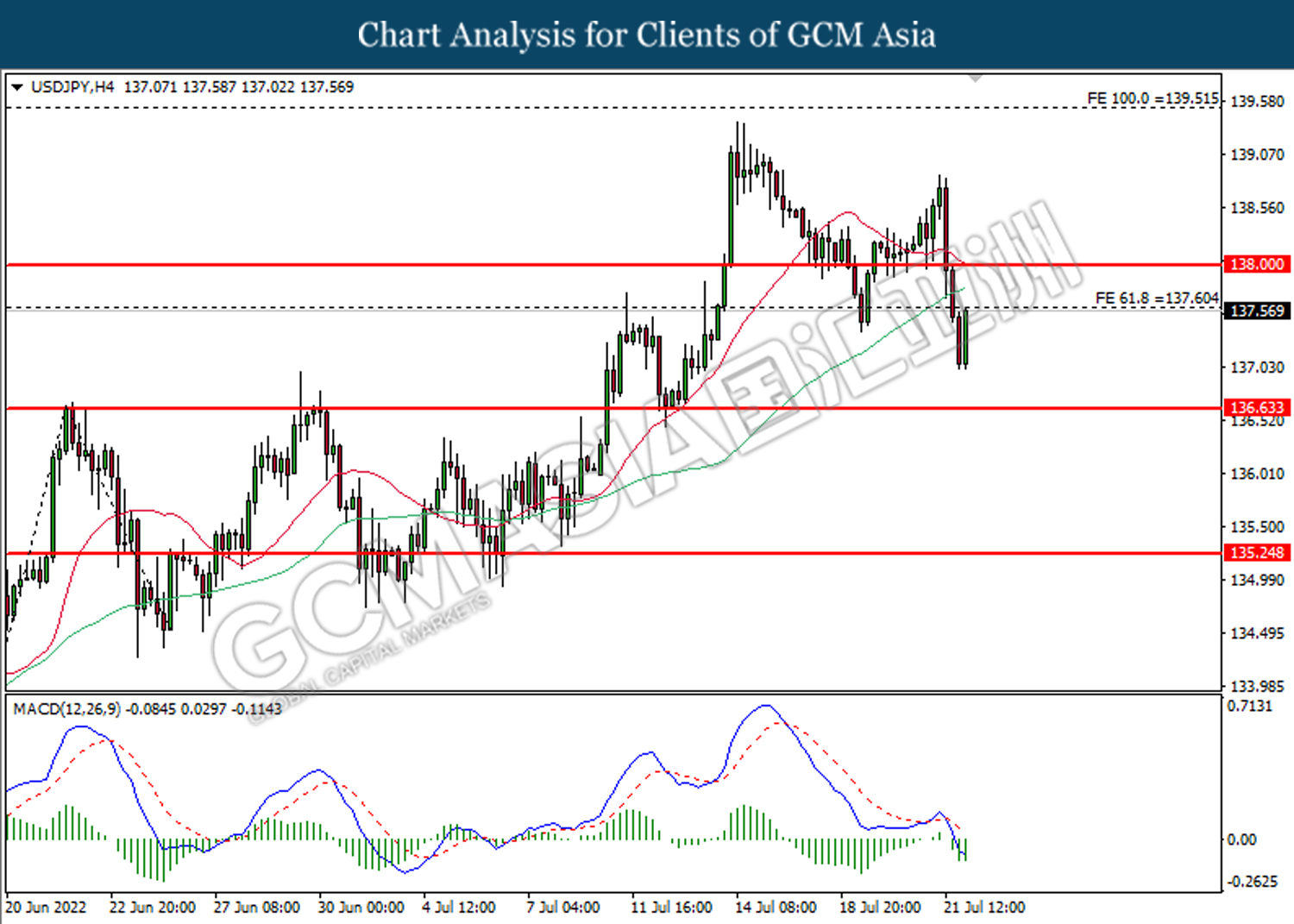

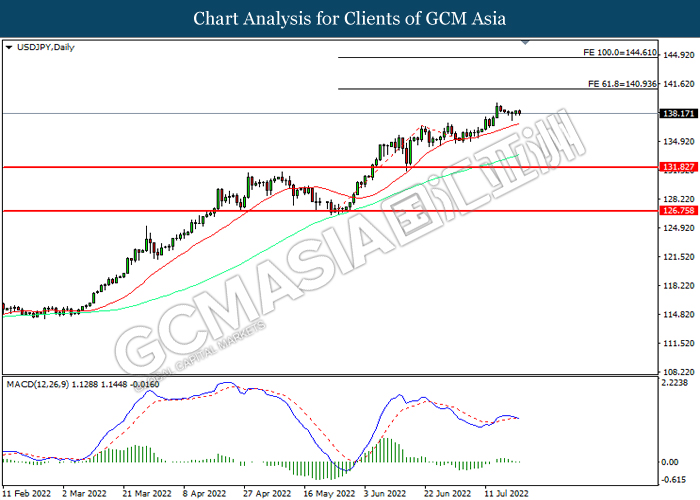

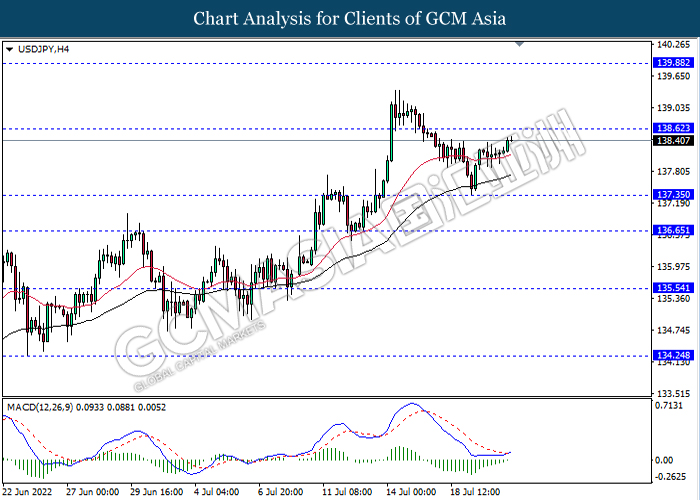

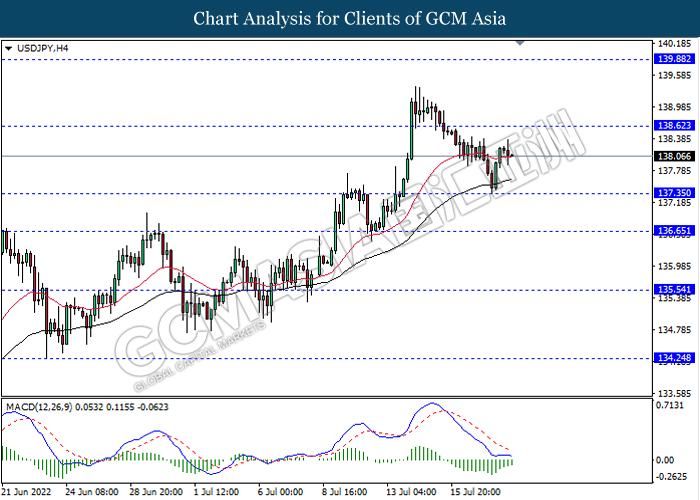

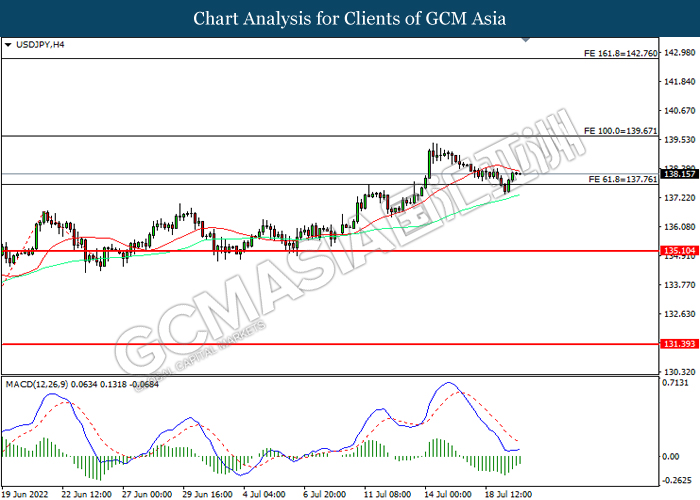

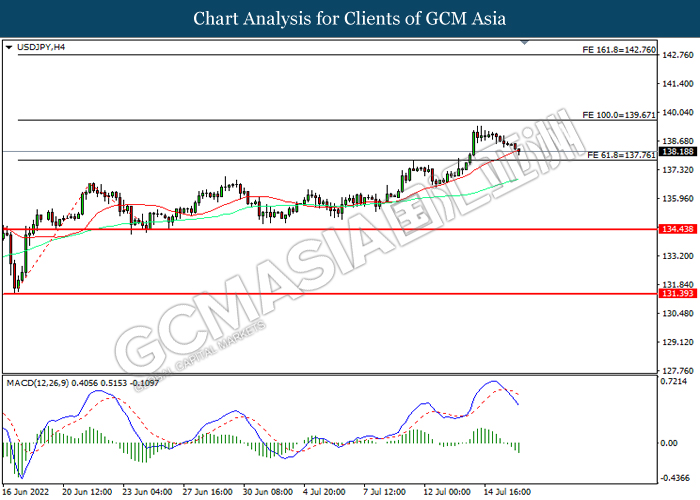

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

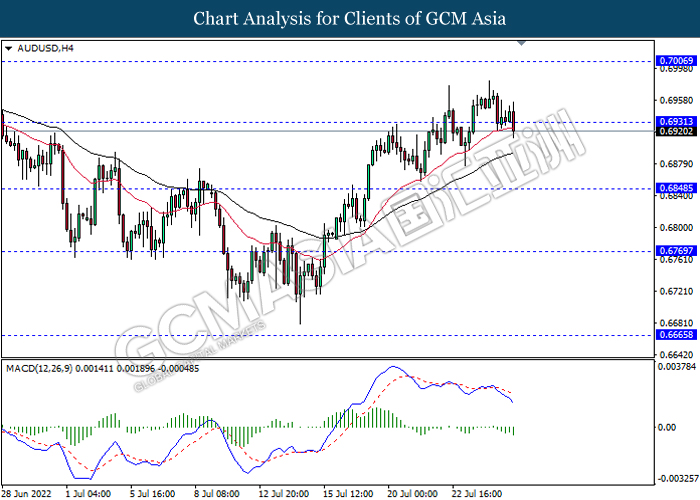

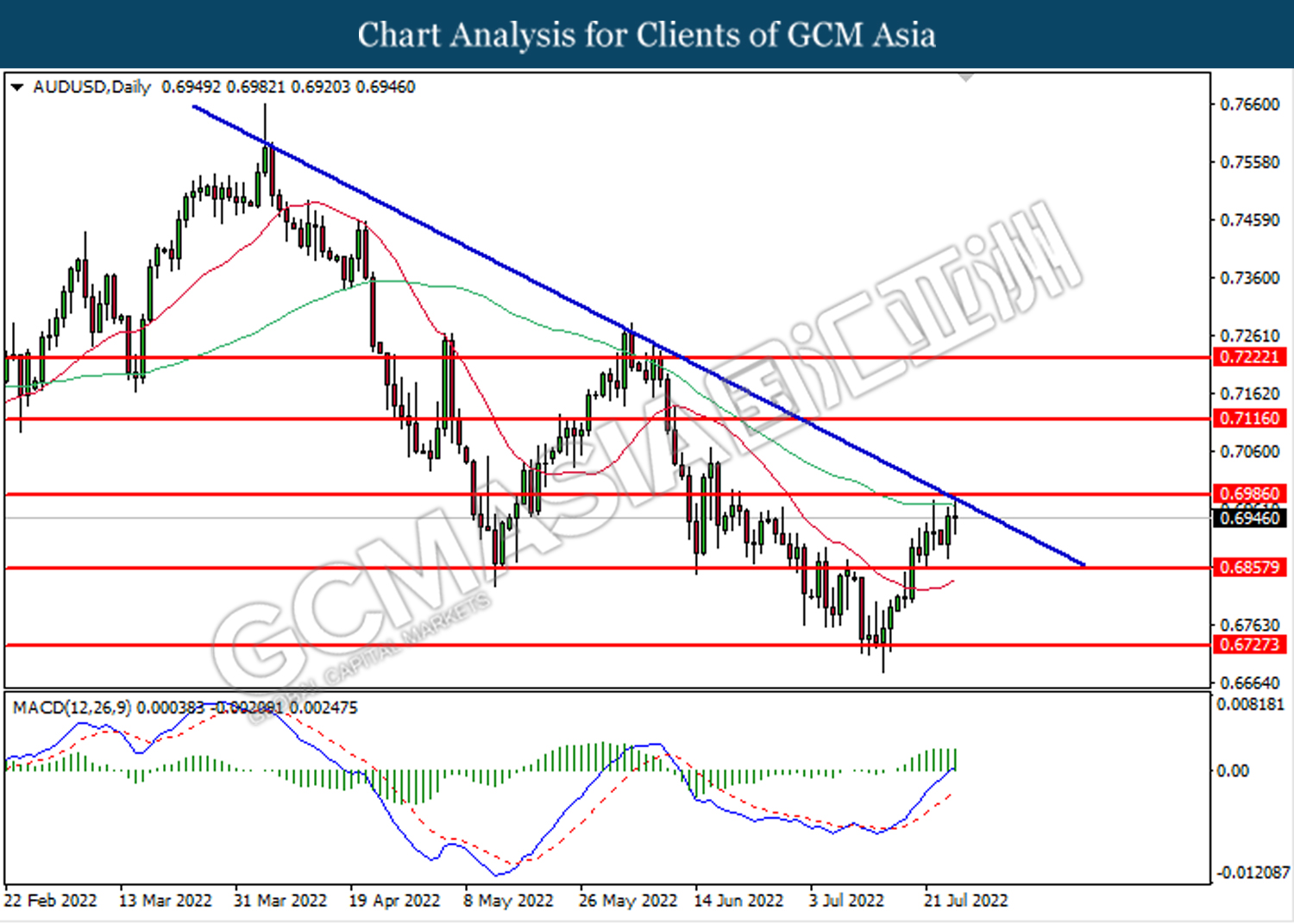

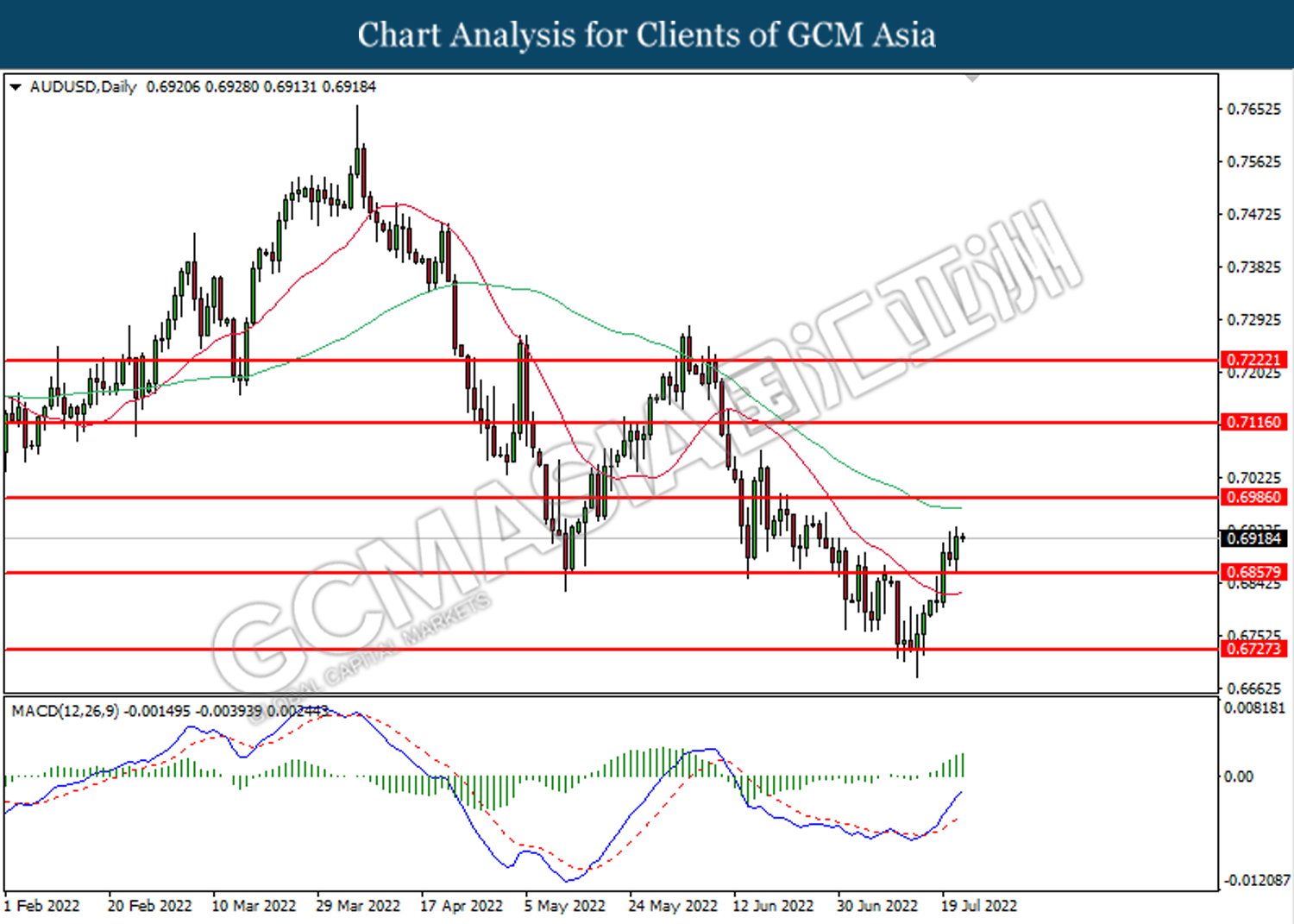

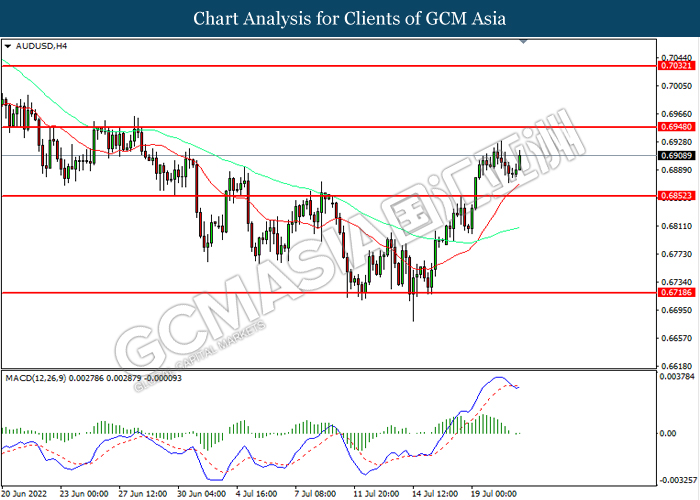

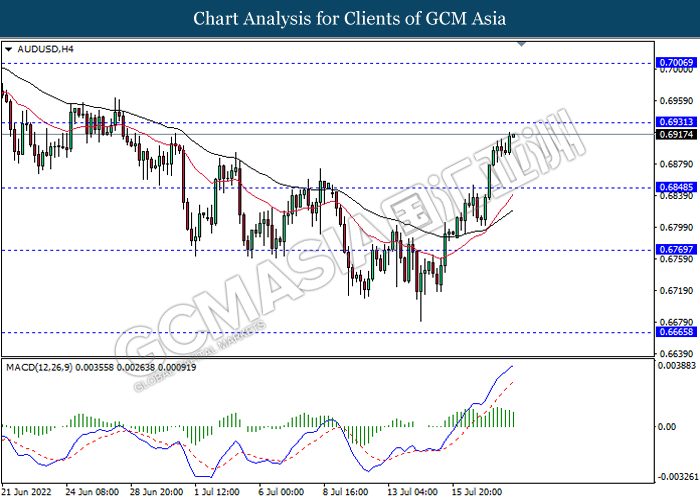

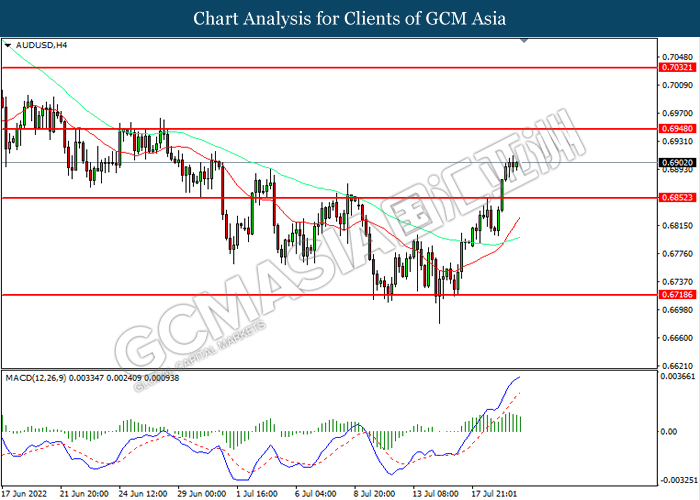

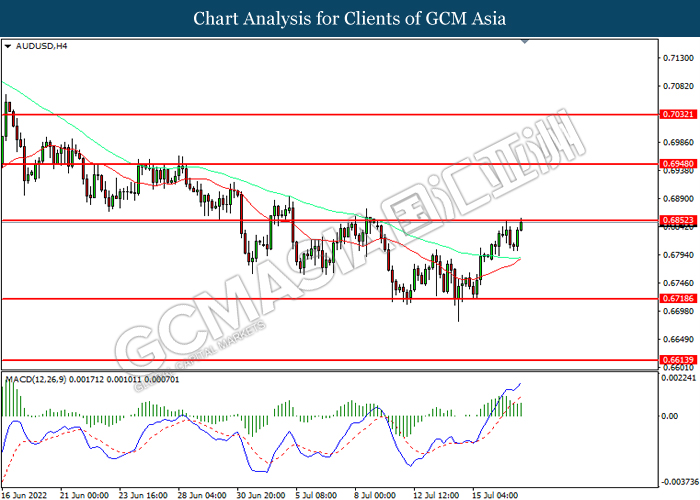

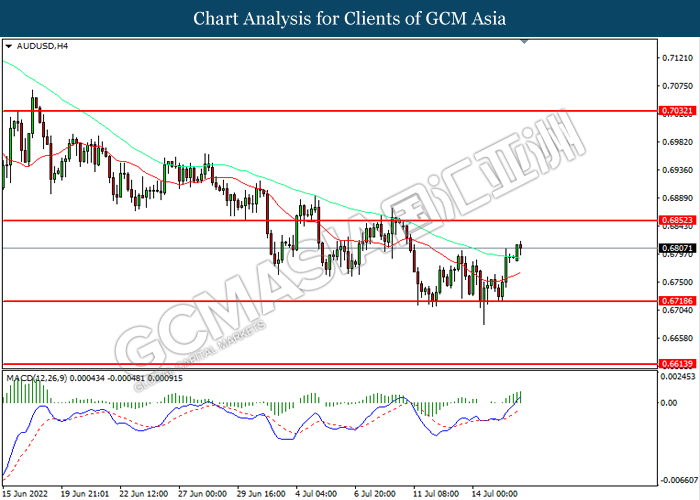

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

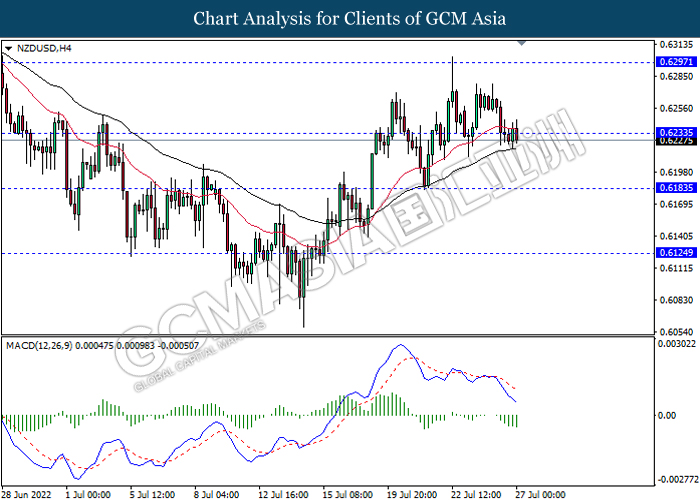

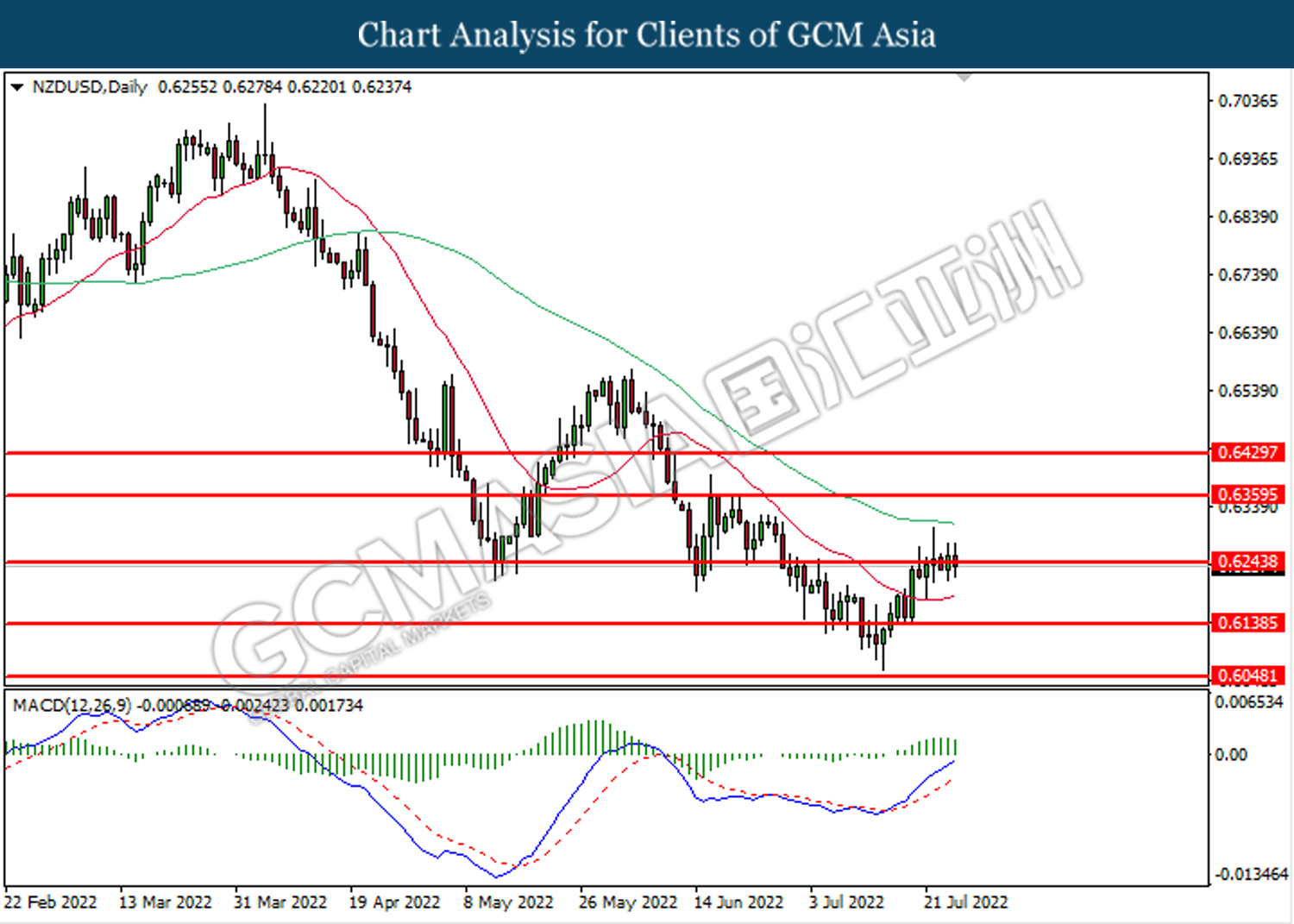

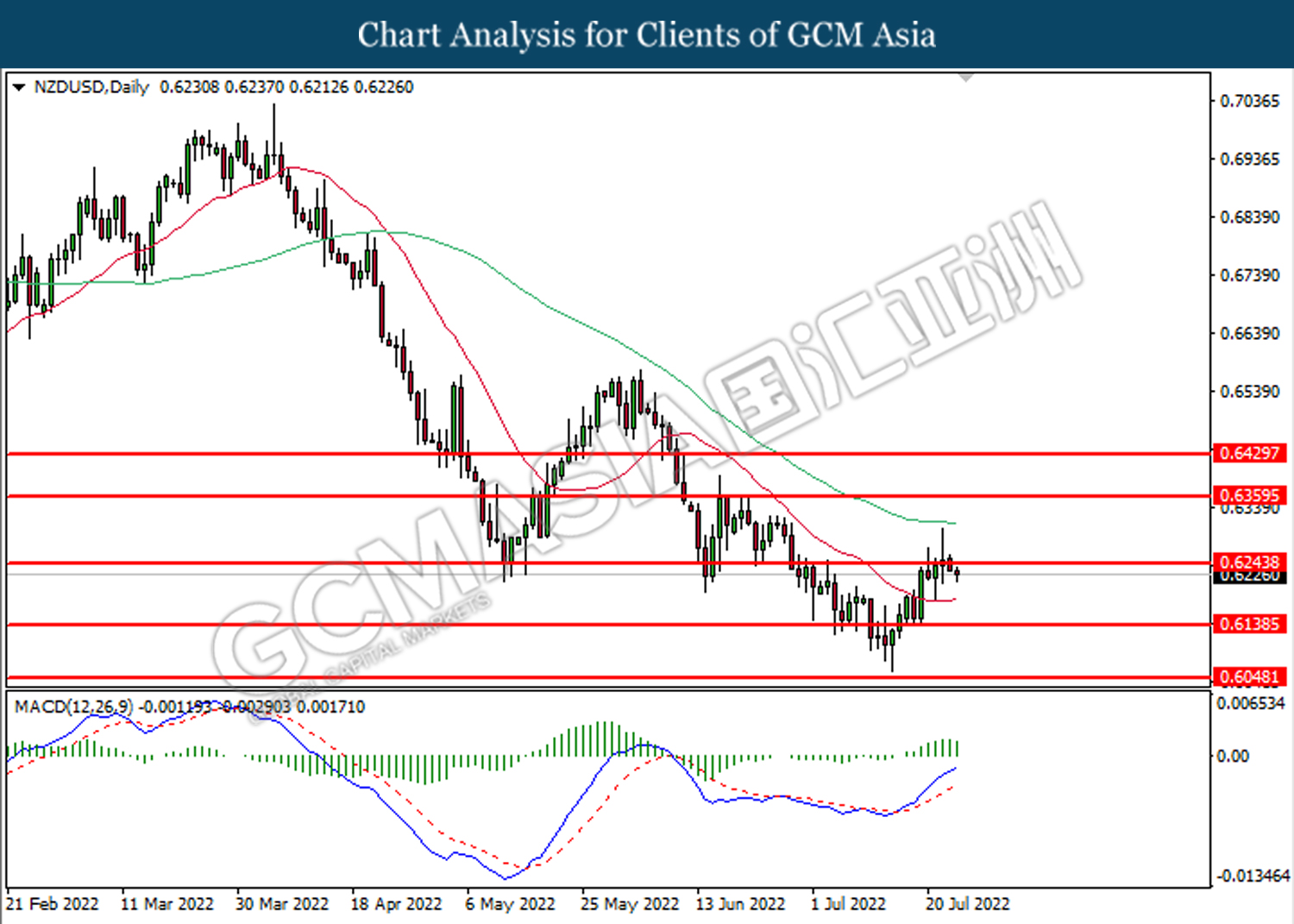

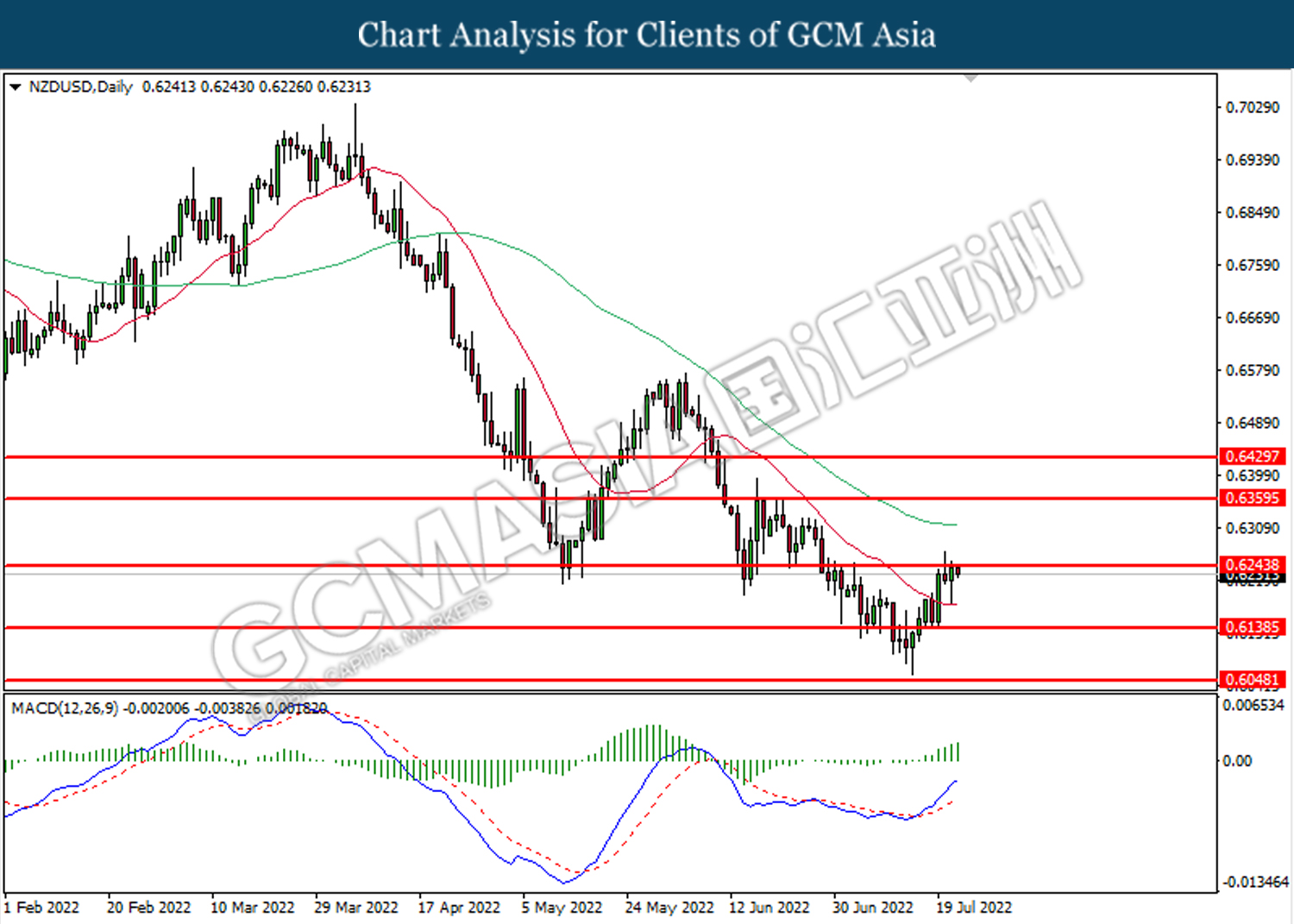

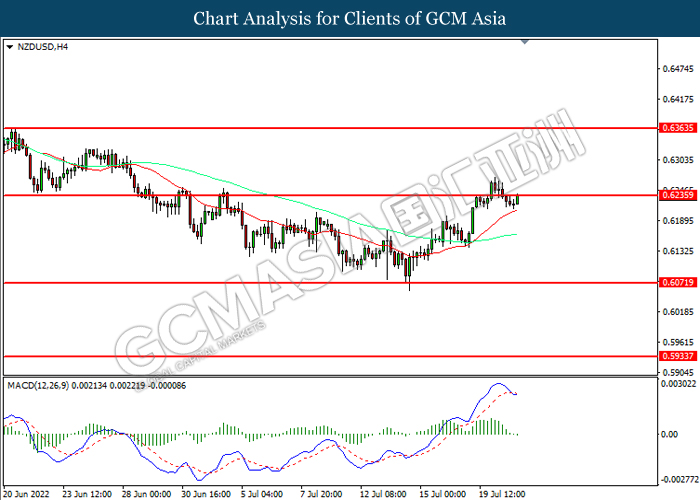

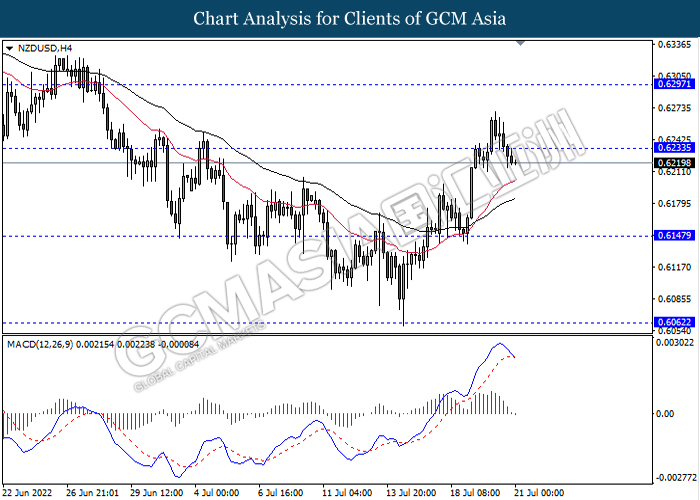

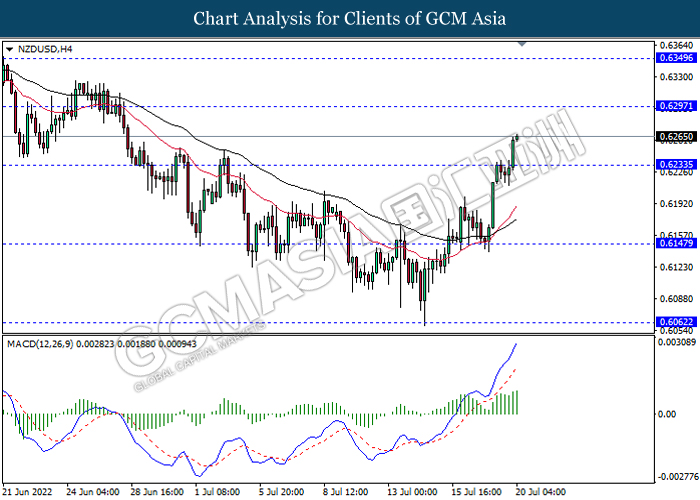

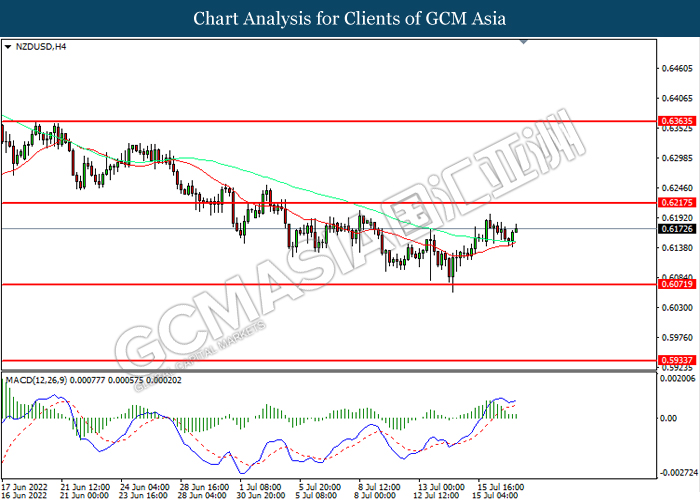

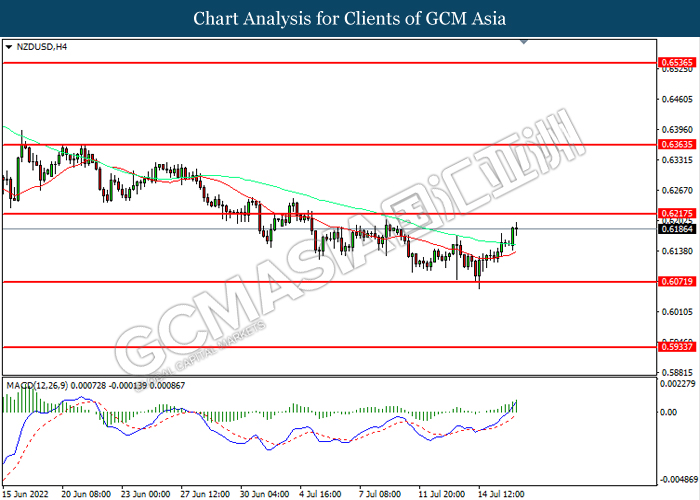

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6235, 0.6295

Support level: 0.6185, 0.6125

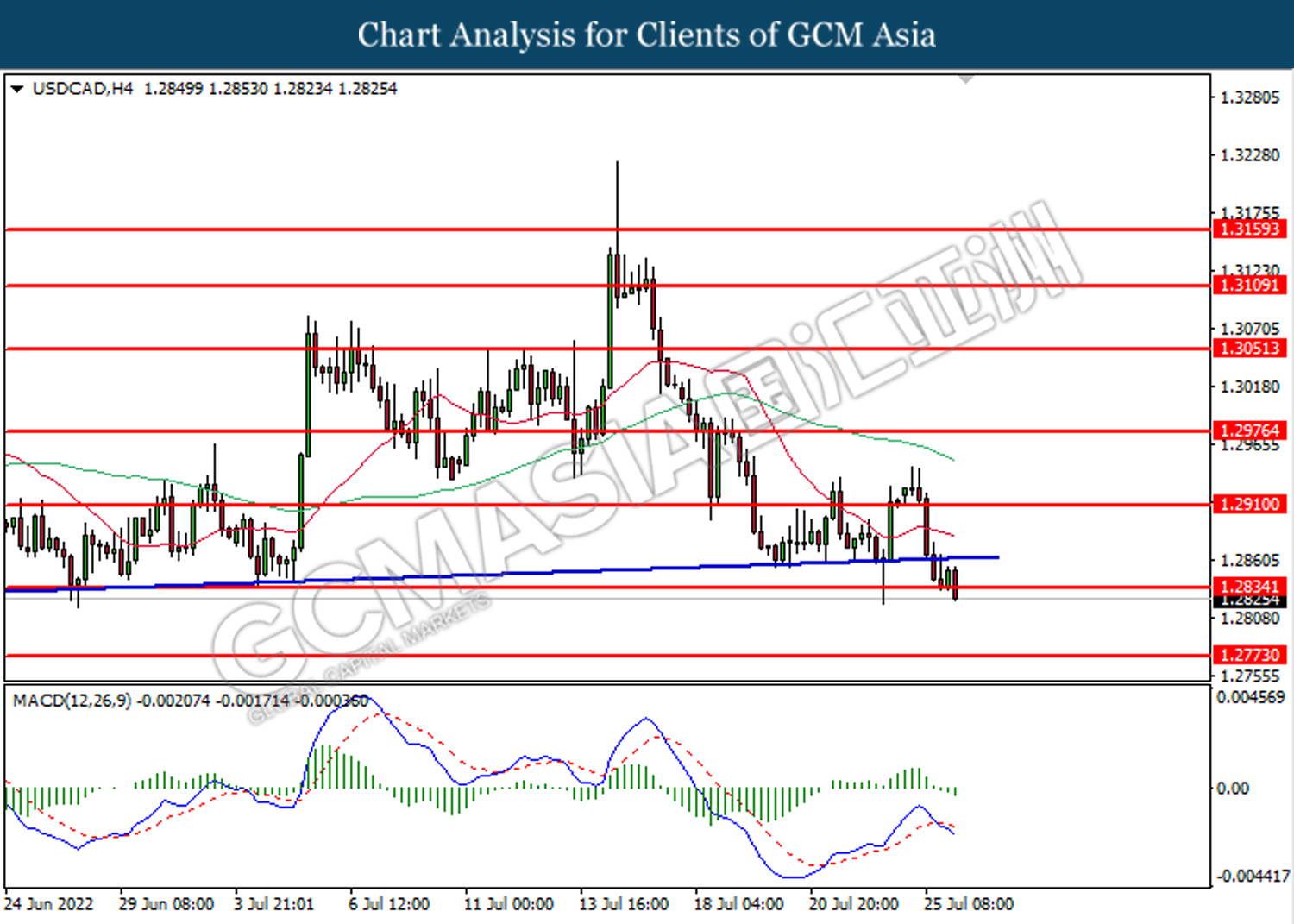

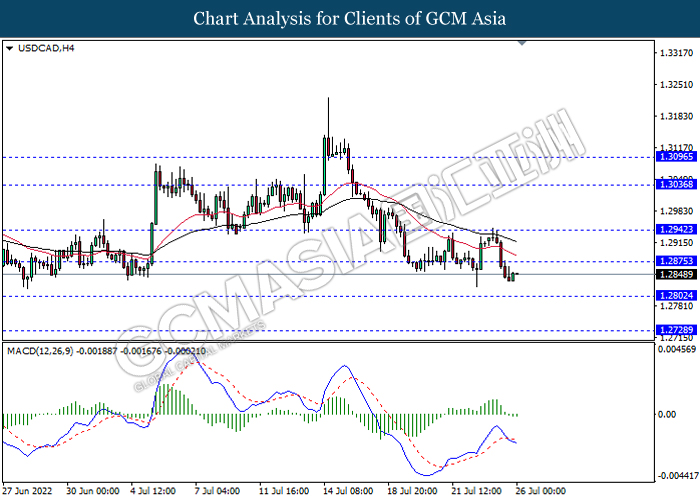

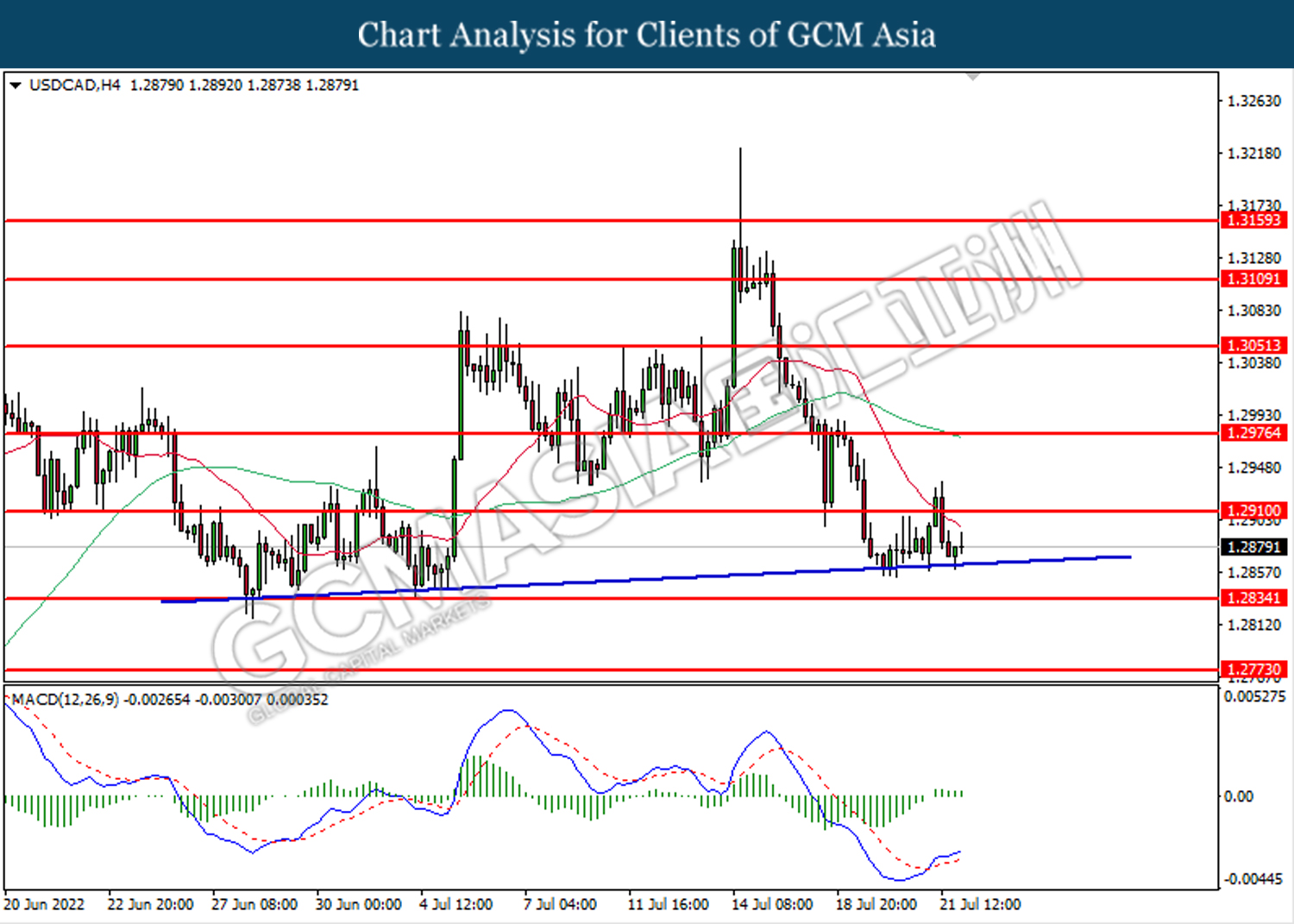

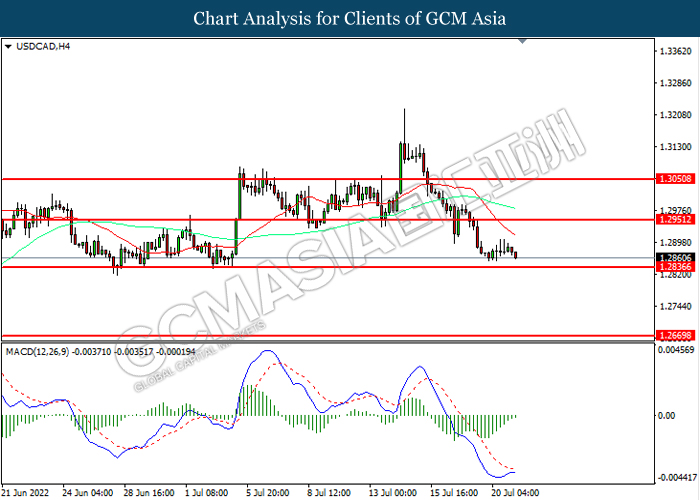

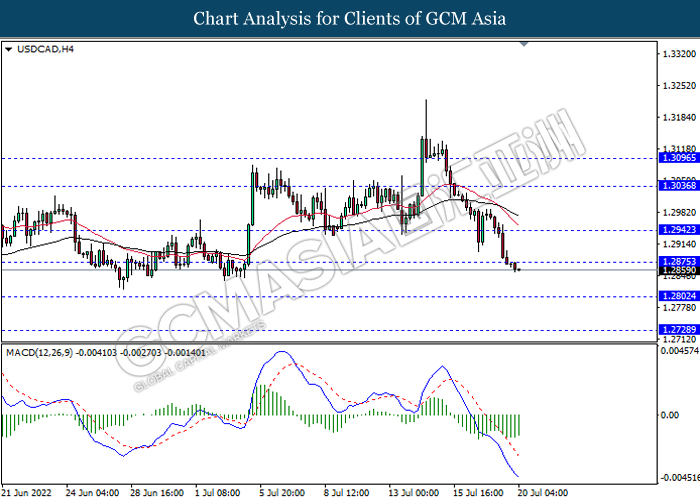

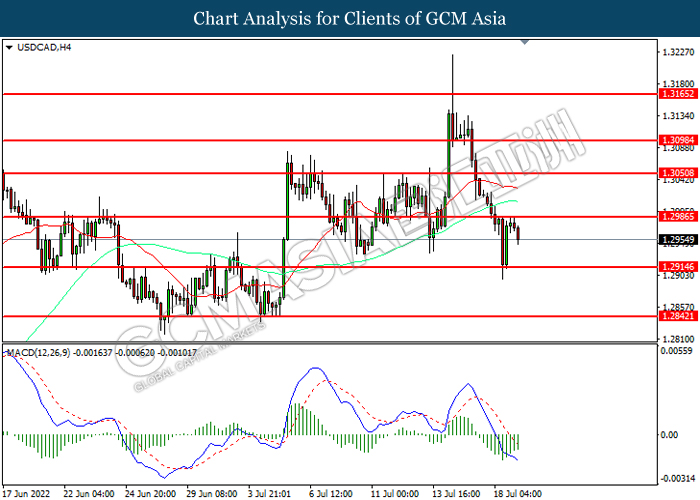

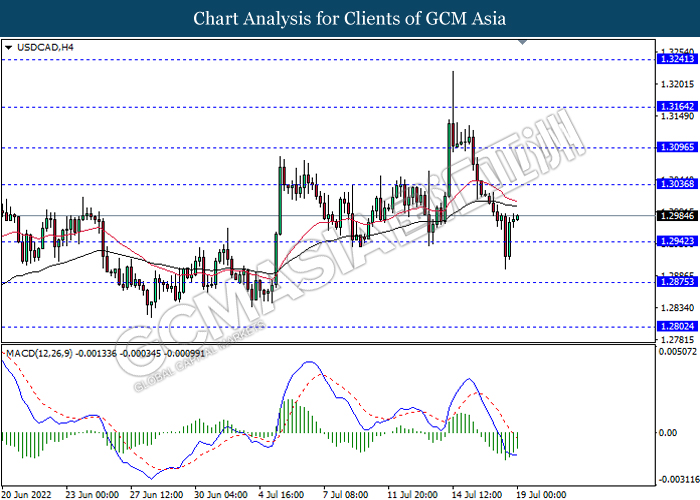

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

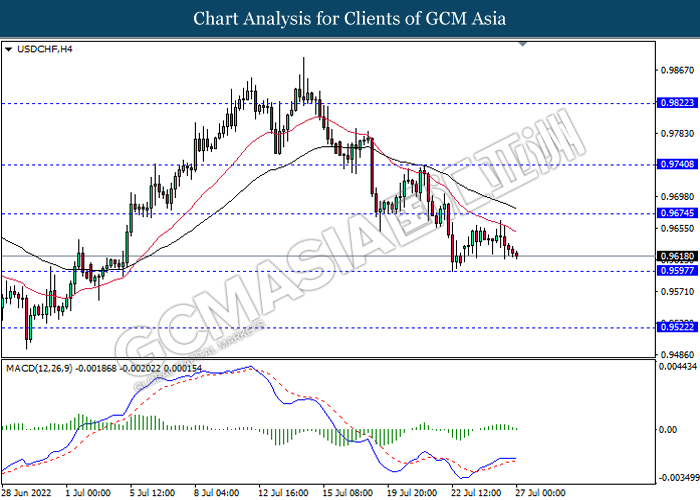

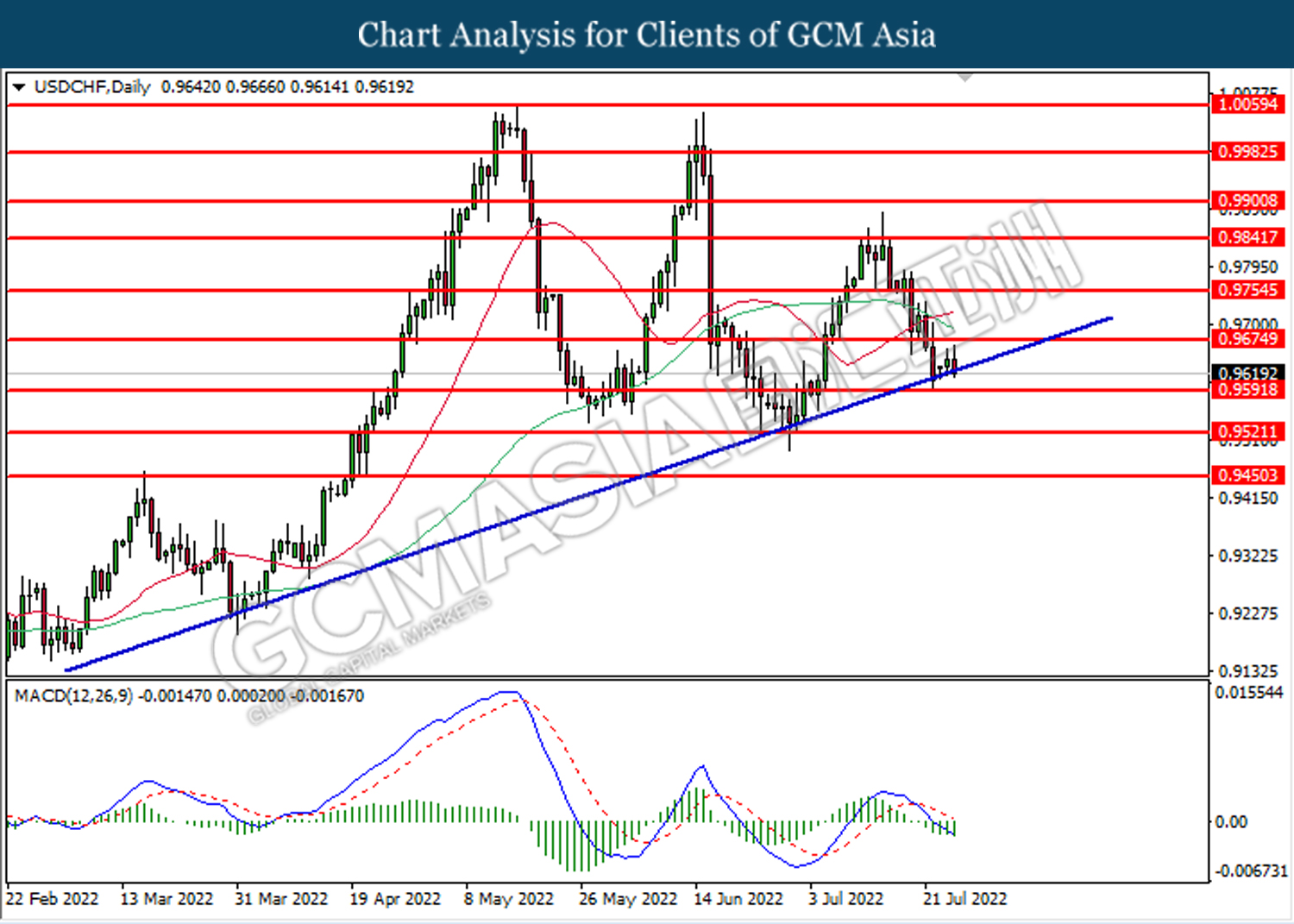

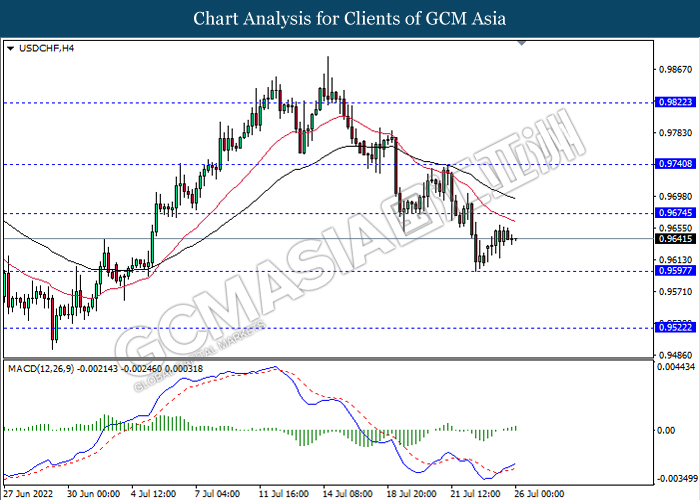

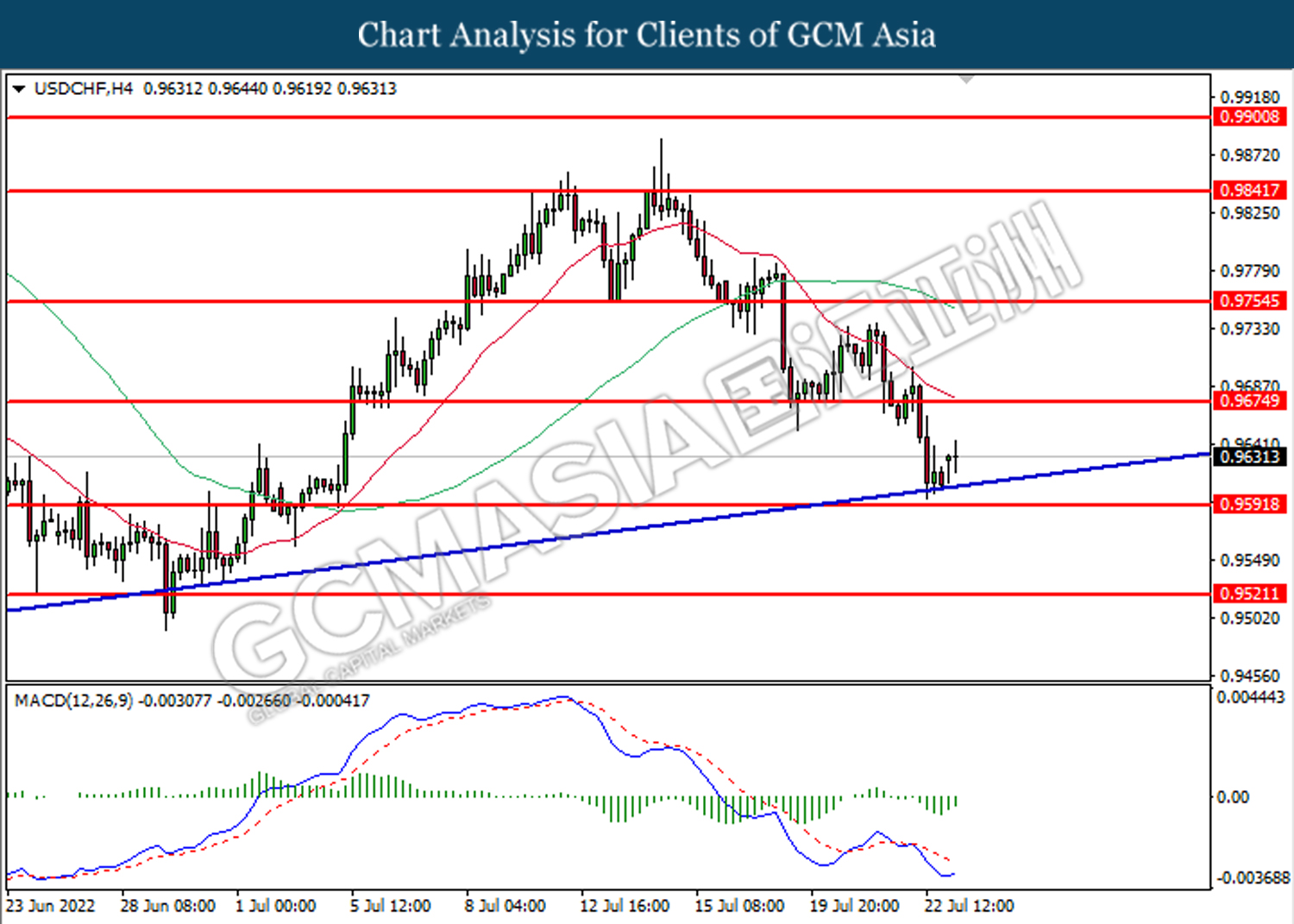

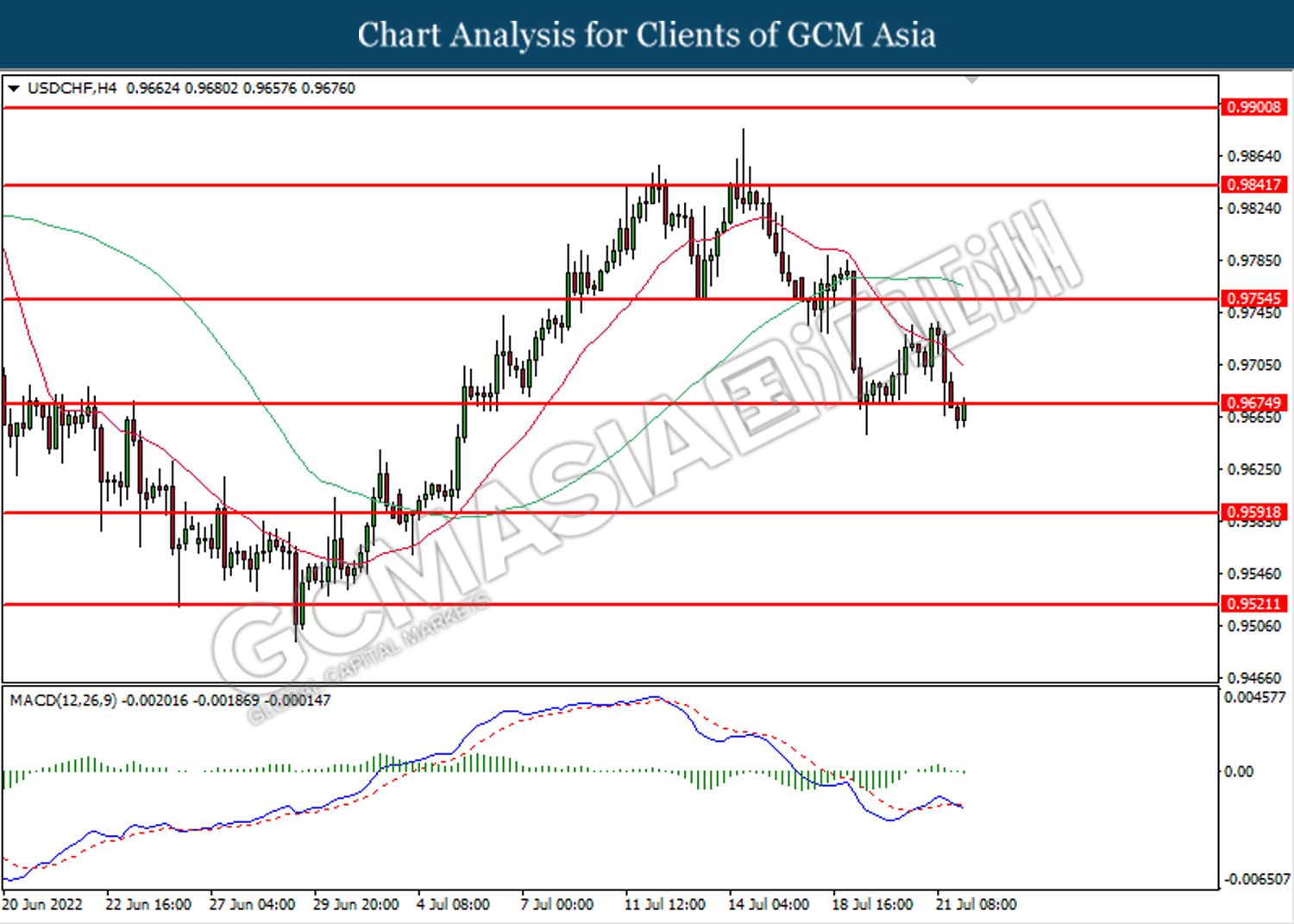

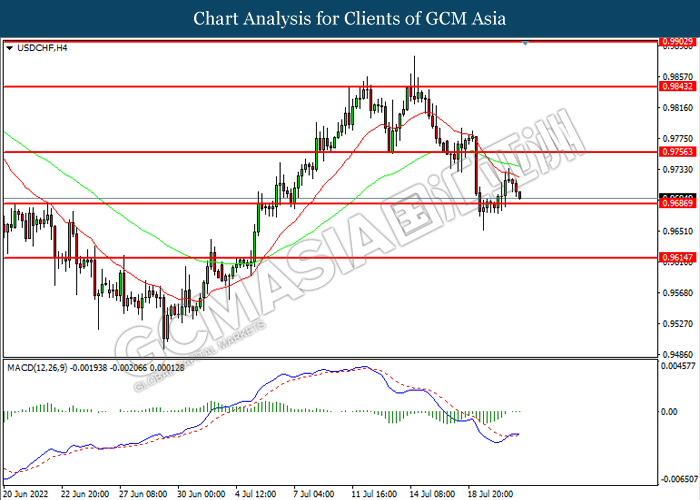

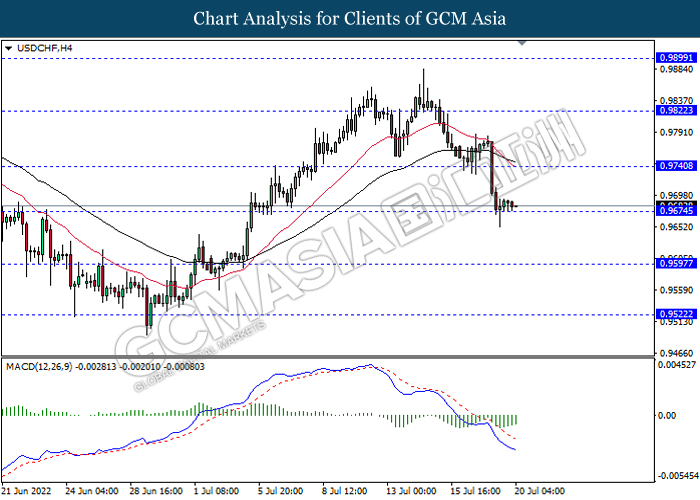

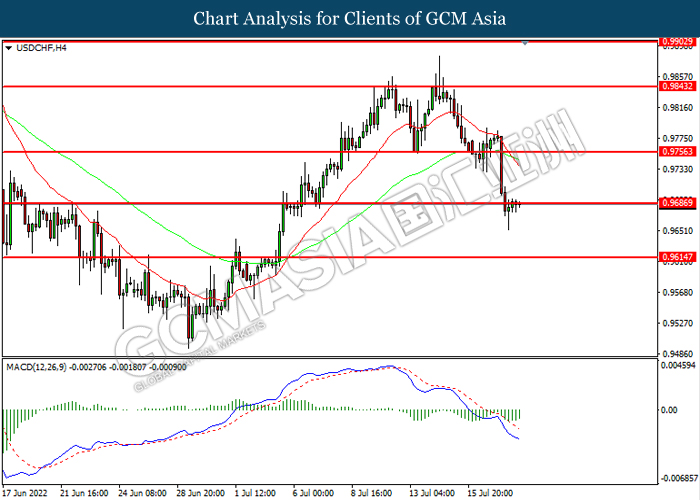

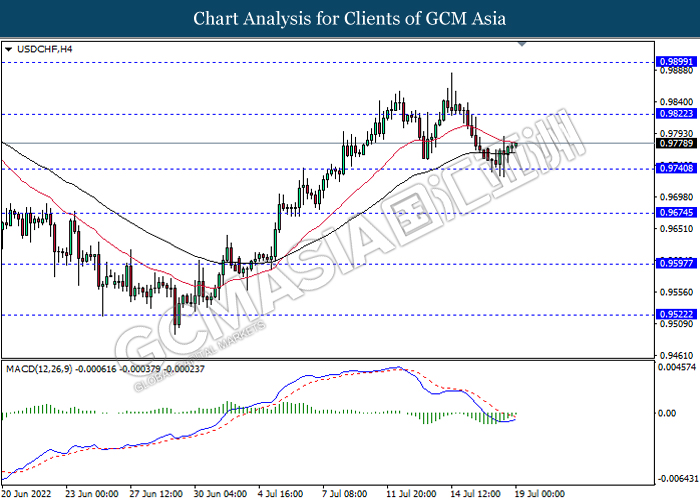

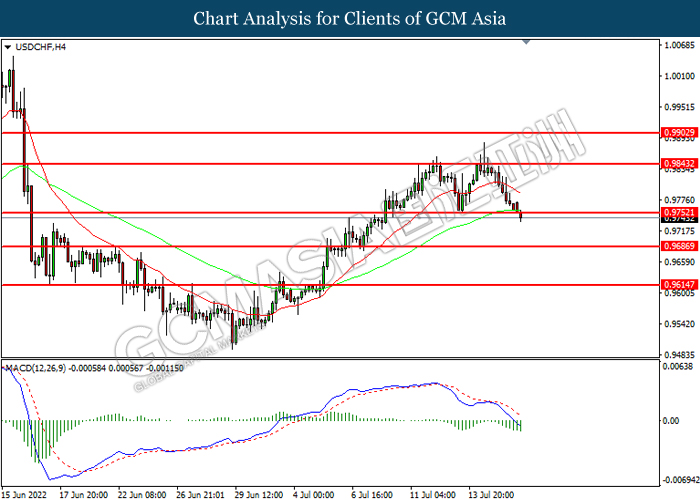

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

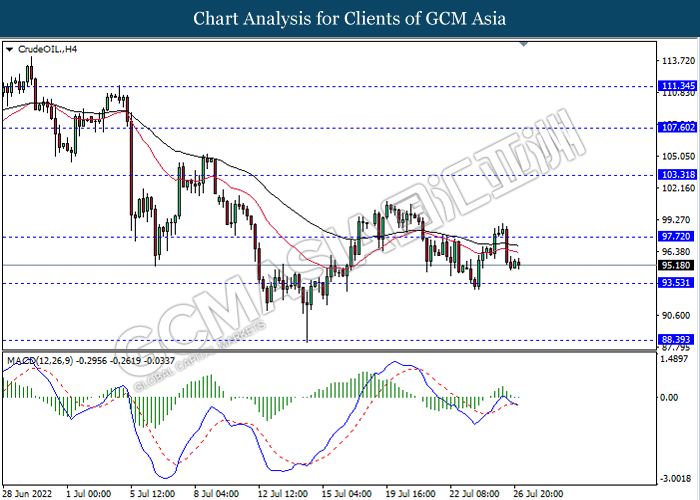

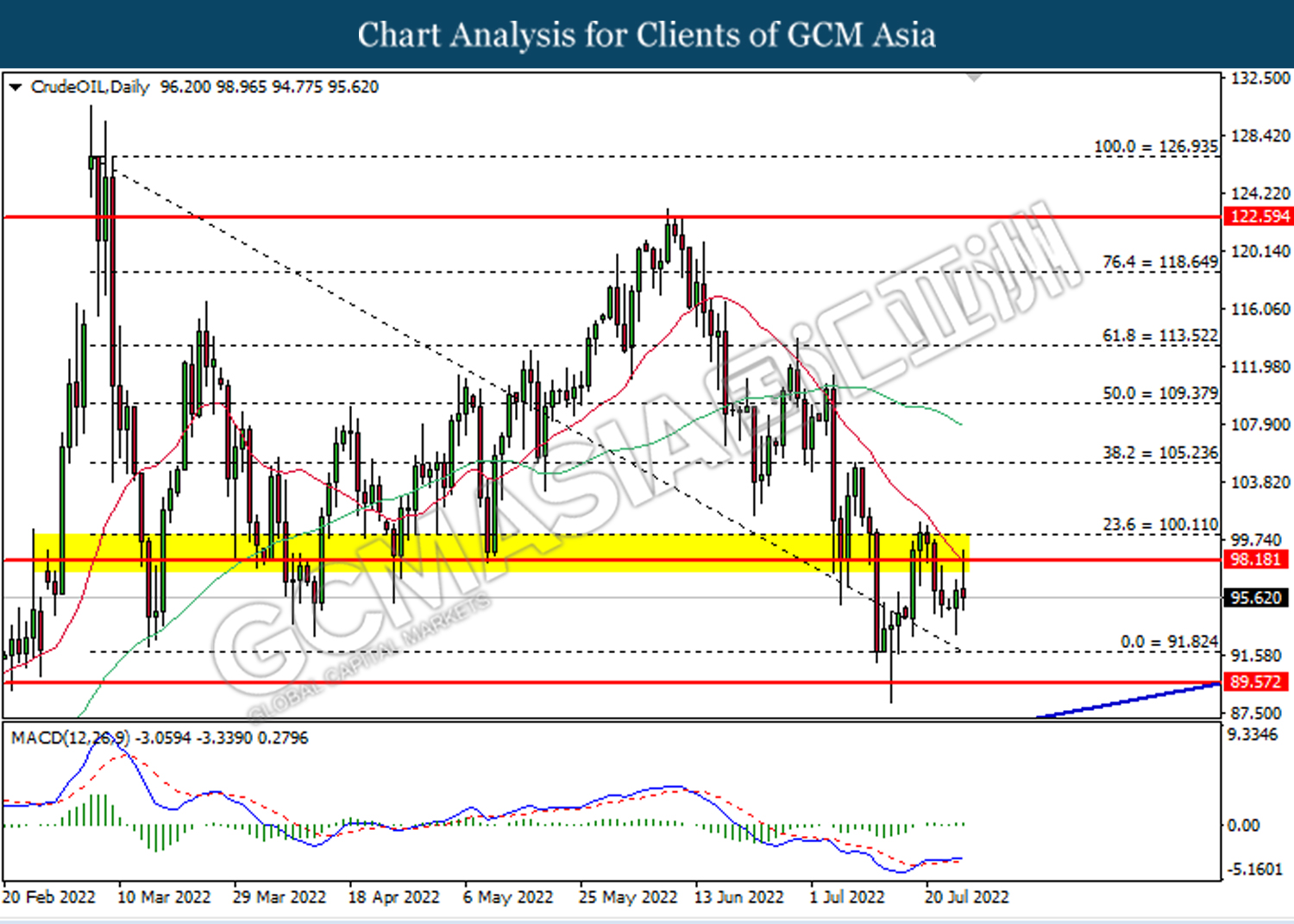

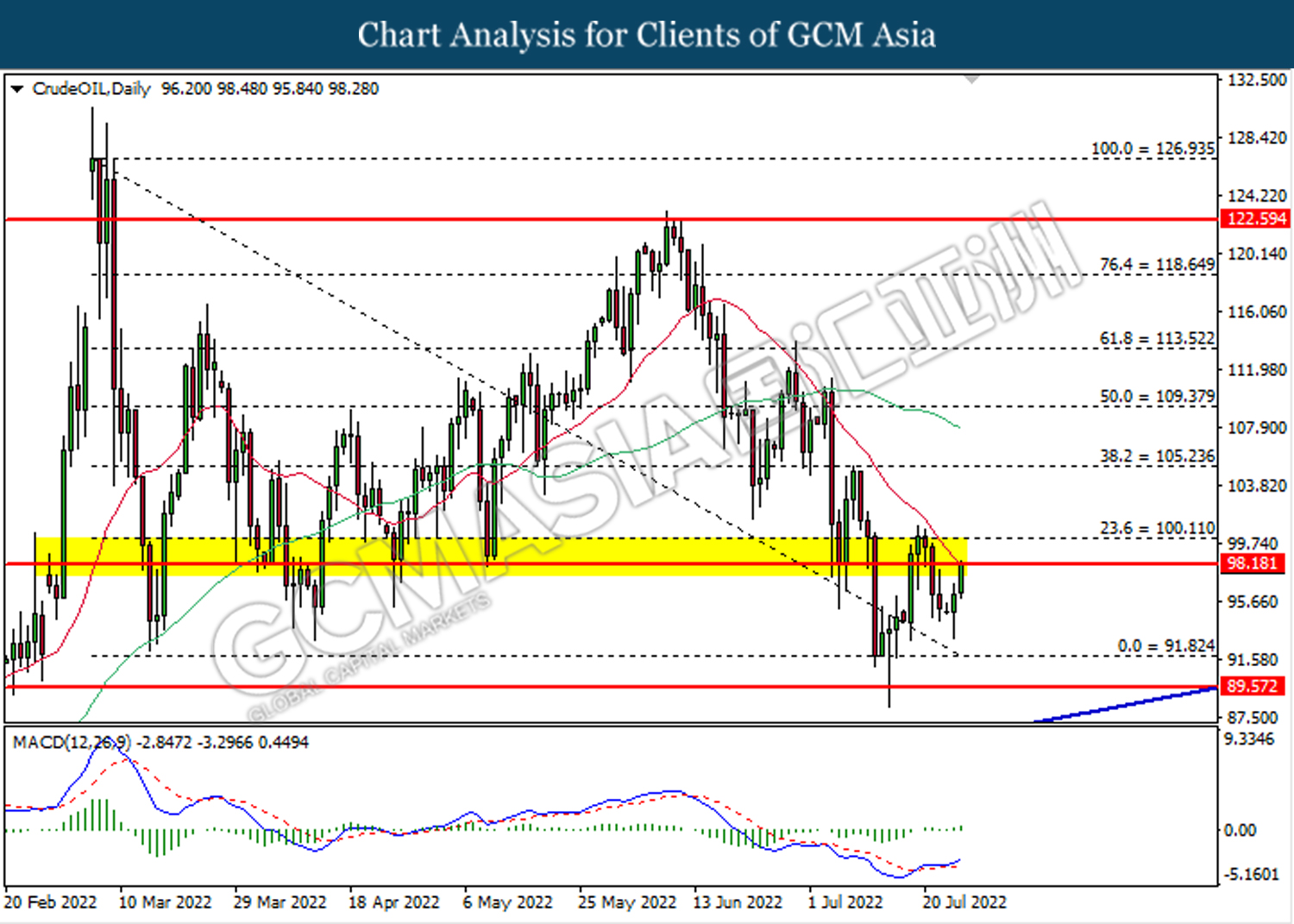

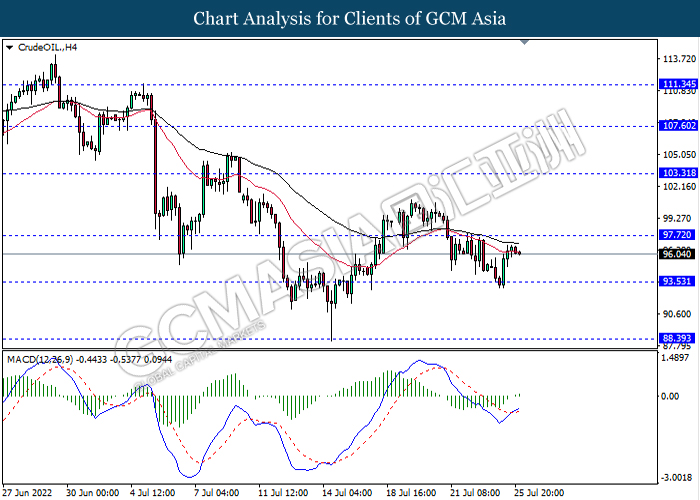

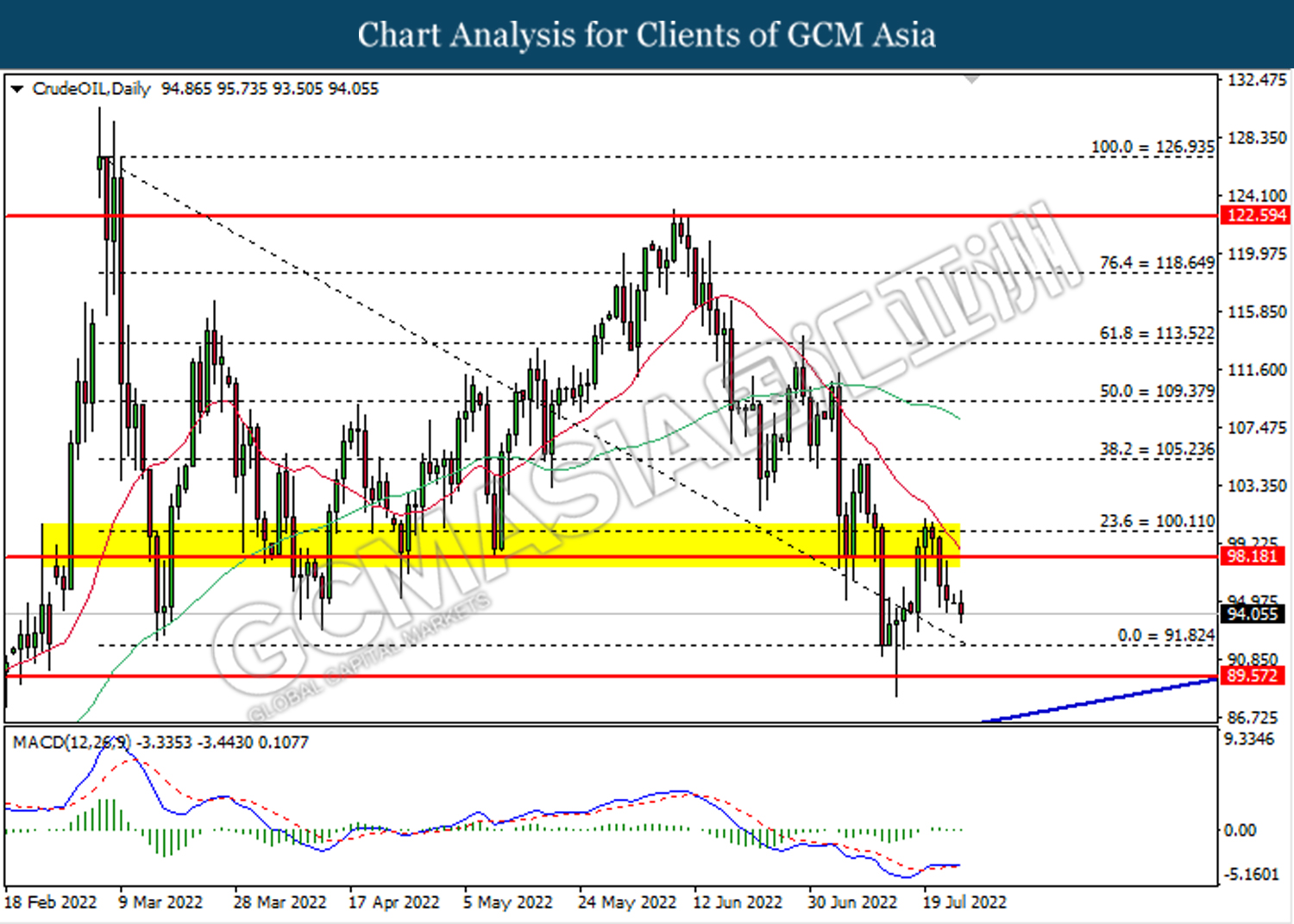

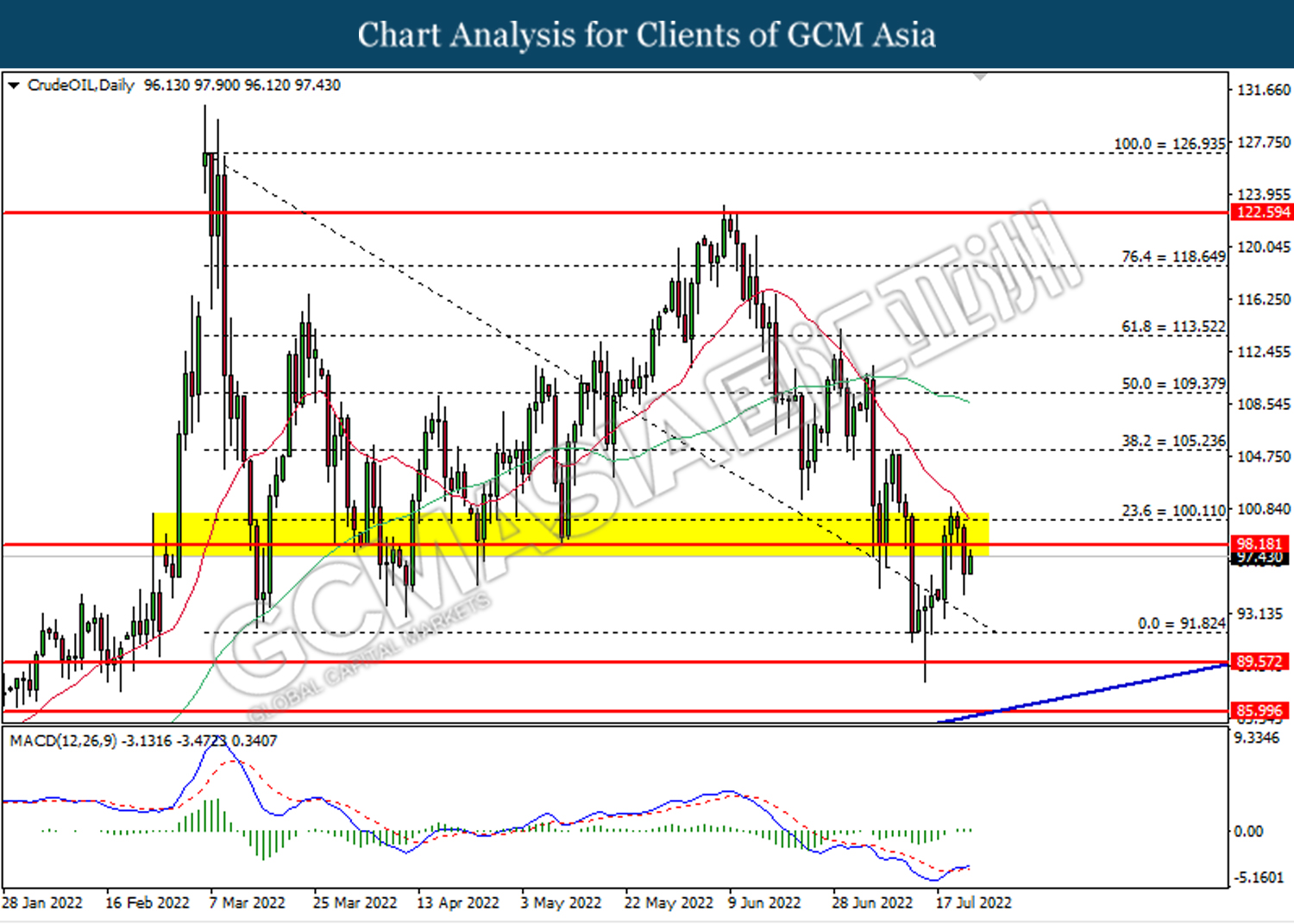

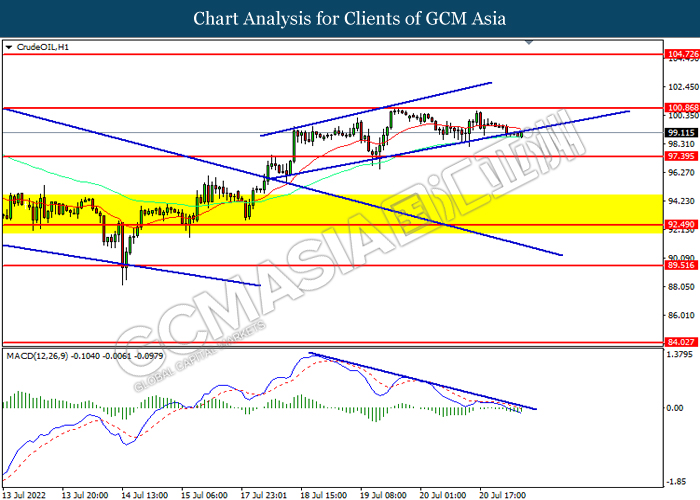

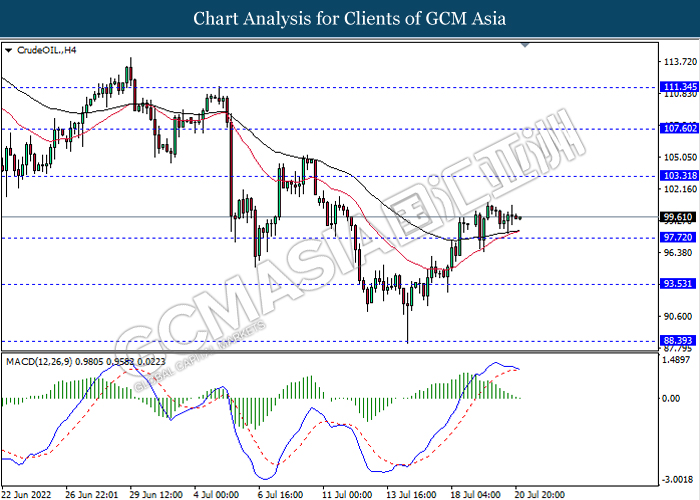

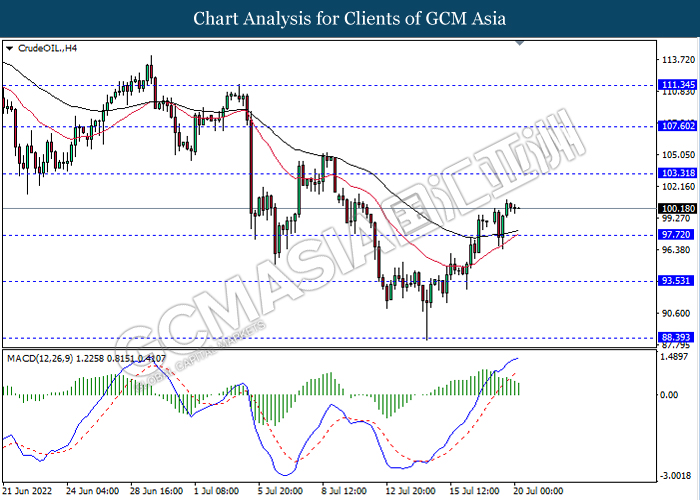

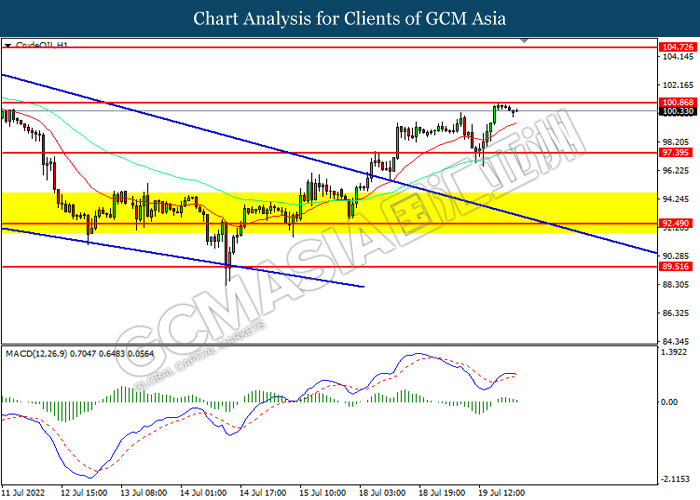

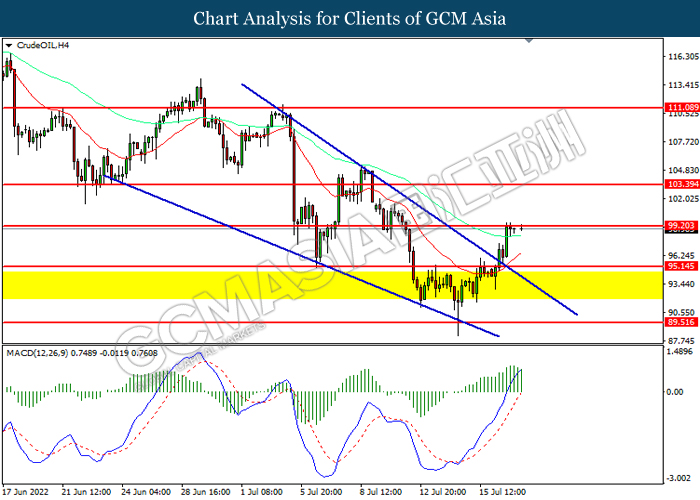

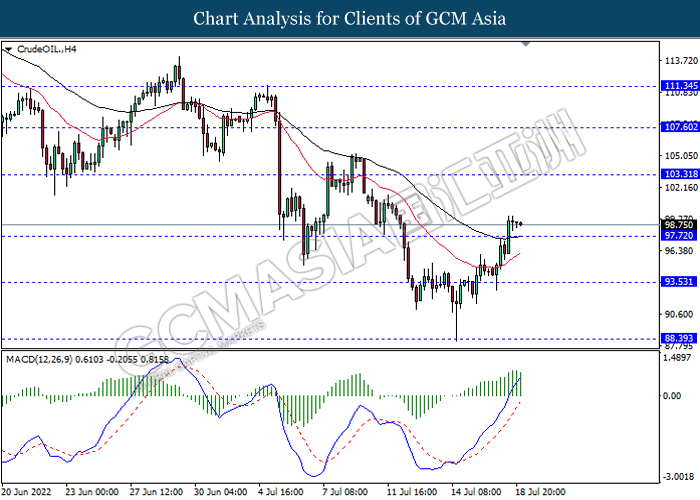

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

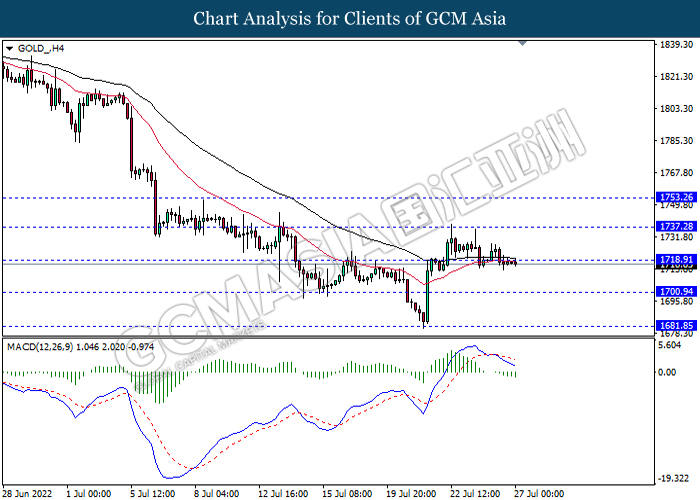

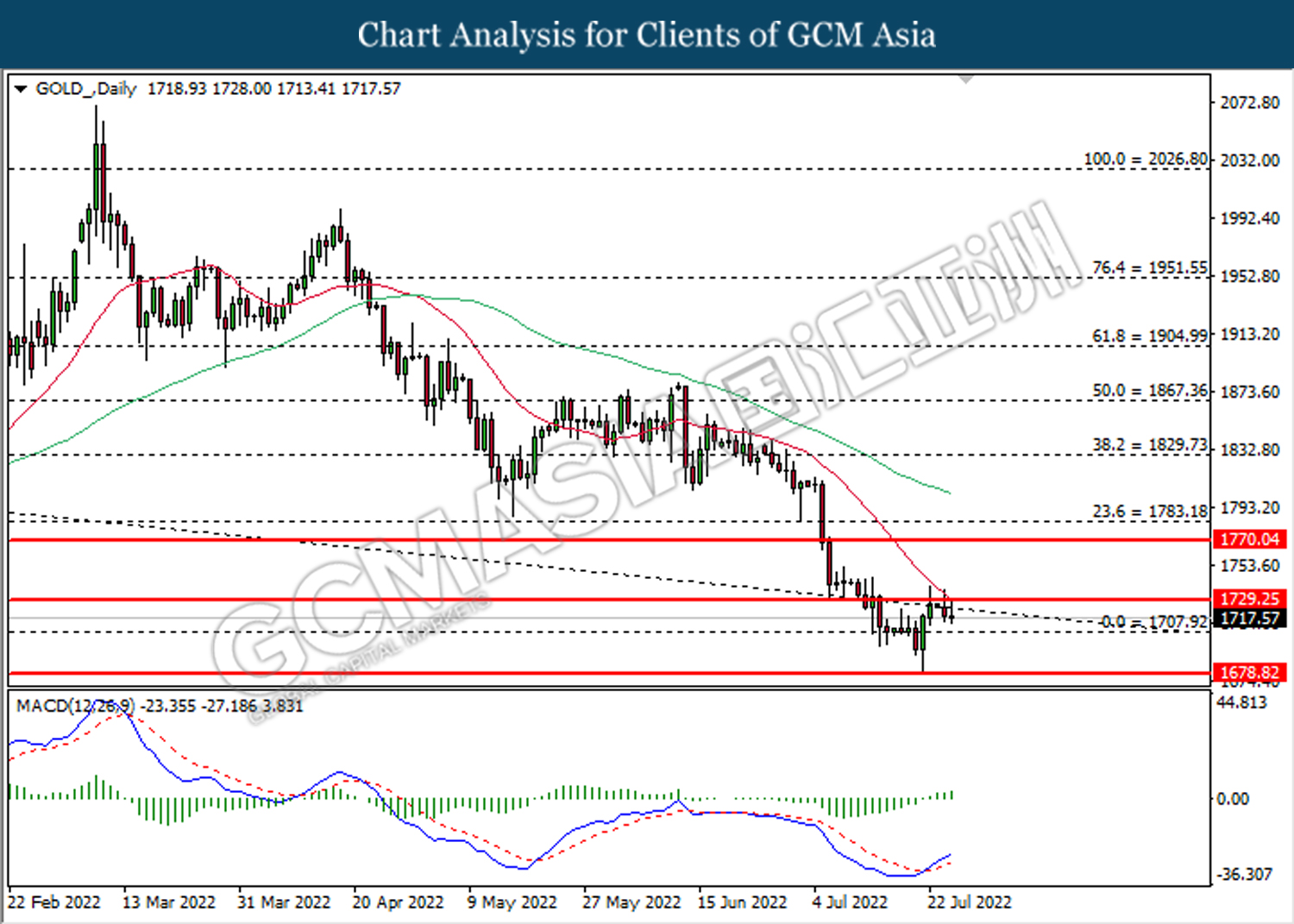

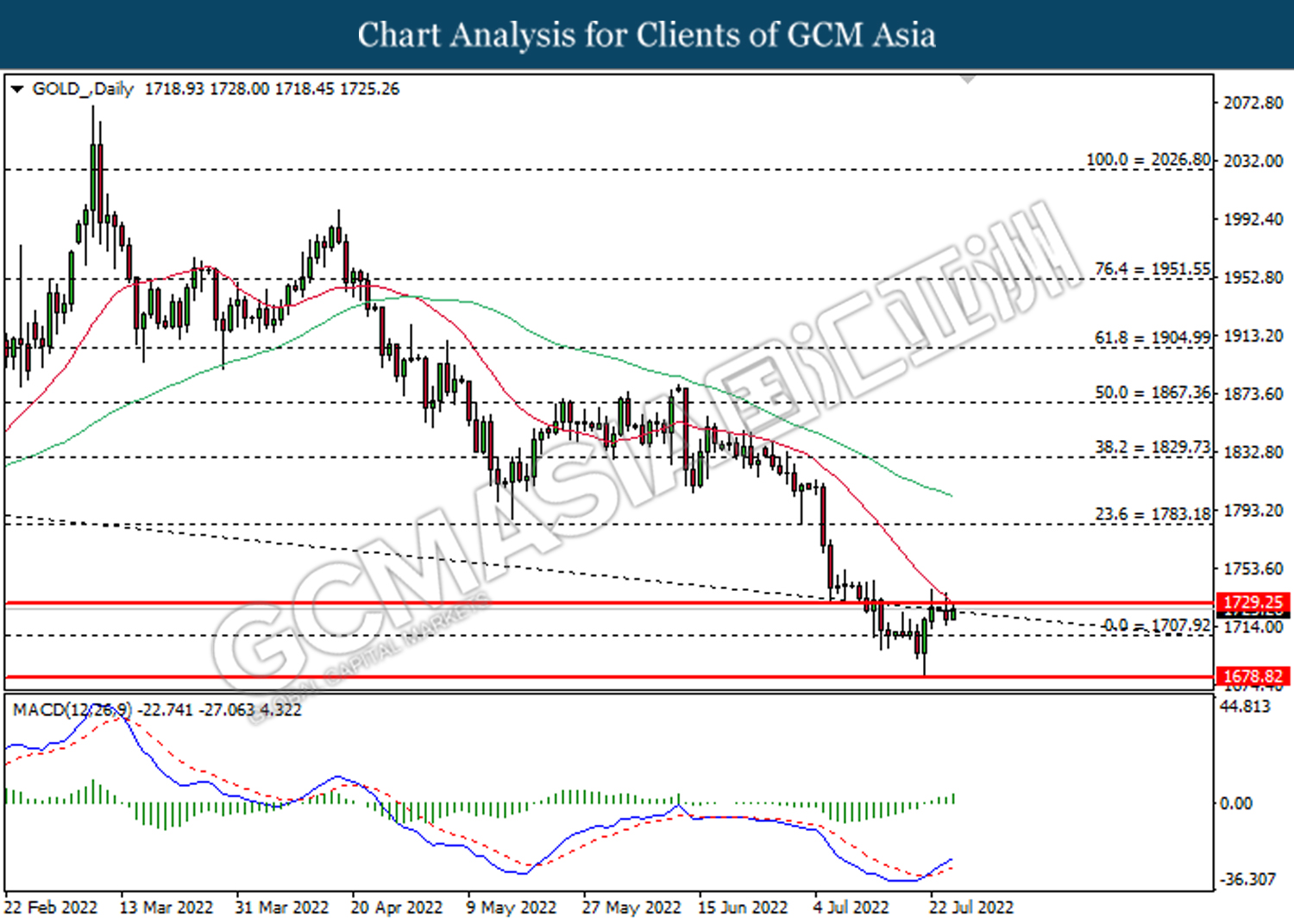

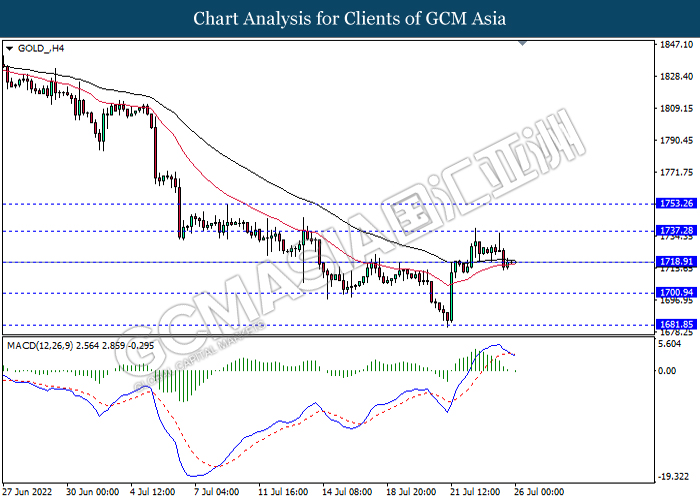

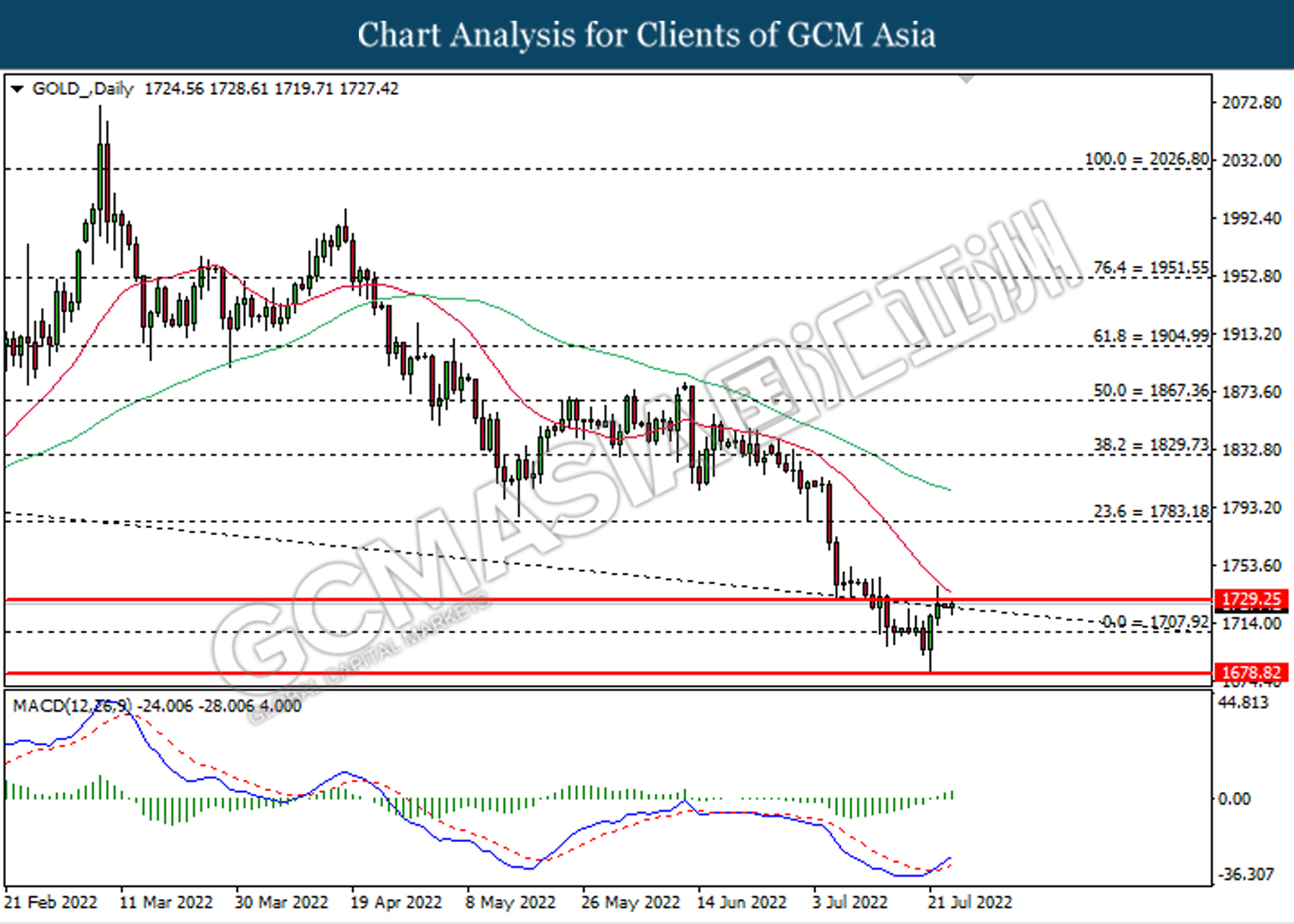

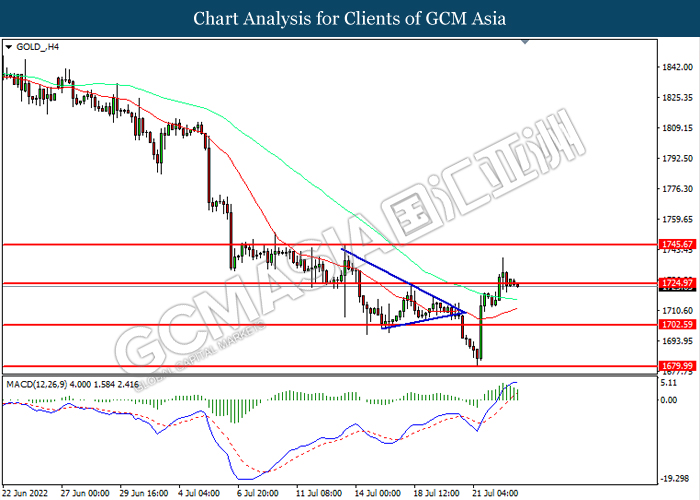

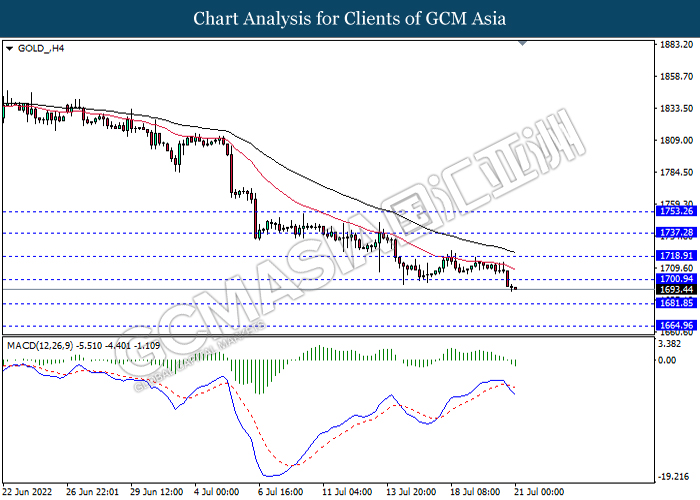

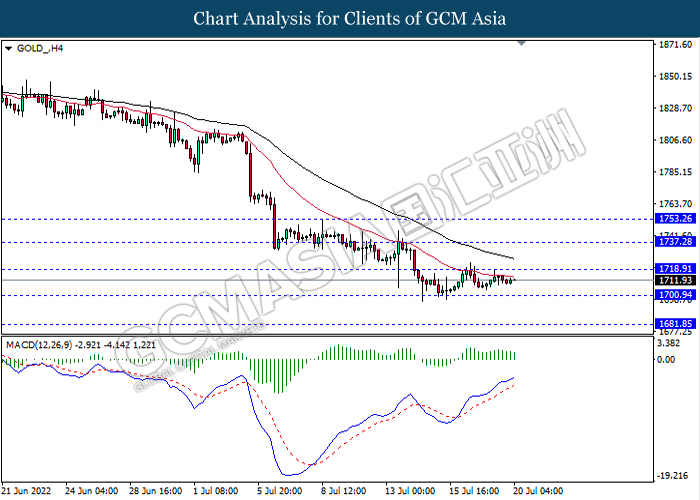

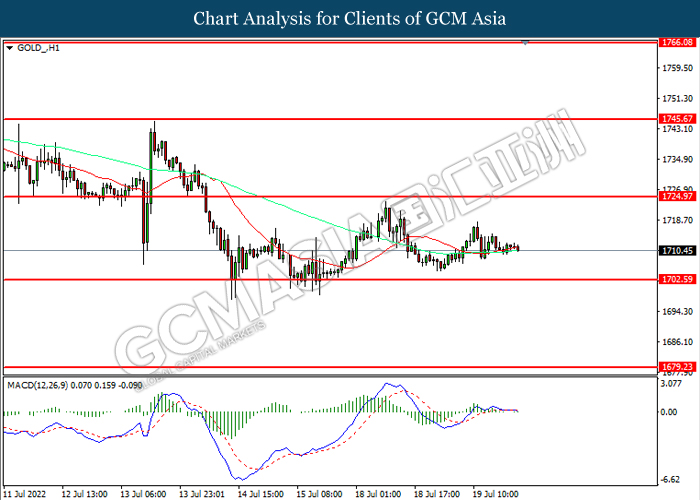

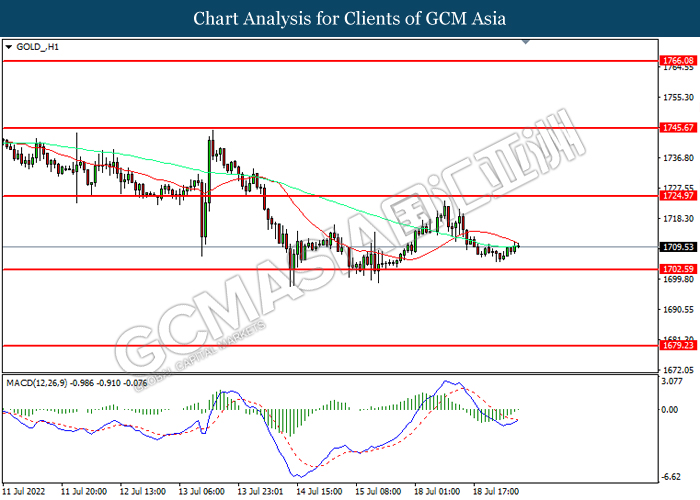

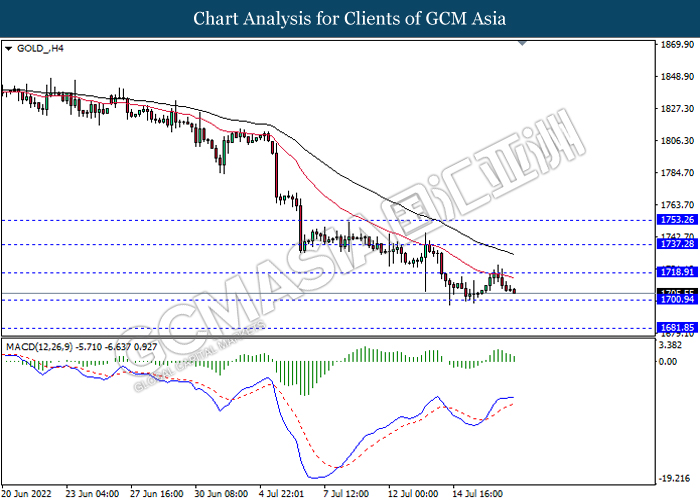

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85

270722 Morning Session Analysis

27 July 2022 Morning Session Analysis

Dollar jumped as recession worries heightened.

The dollar index, which traded against a basket of six major currencies reversed its course successfully, after falling for 3 consecutive trading day amid the heightening of market concern over the recession risk. Recently, the Russian gas giant Gazprom announced a plan to reduce its gas flow via Nord Steam 1 pipeline to Germany, claiming that the purpose of shutting down one of the two remaining working turbines was due to technical issues at a pumping facility on the Baltic coast. However, the German government stated there was no technical reason for it to limit the supply. On the other side, the Eurozone have come into a consensus that an emergency plan to cut the natural gas consumption by 15% over the next nine months would be implemented, aiming to reduce the reliance against Russia natural gas. The exacerbating of tensions between Europe and Russia has spurred the risk-off sentiment in the market, prompted the investors to move their holdings toward safe haven dollar. At this juncture, investors are eyeing on the upcoming Federal Reserve meeting in order to gauge the likelihood direction of the dollar index going forward. As of writing, the dollar index surged 0.68% to 107.20.

In the commodities market, the crude oil price up 0.02% to $95.55 a barrel after falling substantially yesterday. The appreciation of the US dollar caused the cost of oil became expensive for the non-US buyers. Besides, the gold prices went down 0.04% to $1717.70 a troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Statement

(28th July)

02:00 USD FOMC Press Conference

(28th July)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.7% | 0.2% | – |

| 22:30 | USD – Pending Home Sales (MoM) (Jun) | 0.7% | -1.5% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.466M | -1.037M | – |

| 02:00

(28thJuly)

|

USD – Fed Interest Rate Decision | 1.75% | 2.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 106.10. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.60.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2035. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2035, 1.2175

Support level: 1.1900, 1.1800

EURUSD, H4: EURUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its rebound toward the resistance level at 1.0155.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 1.0000

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 137.60.

Resistance level: 137.60, 138.00

Support level: 136.65, 135.25

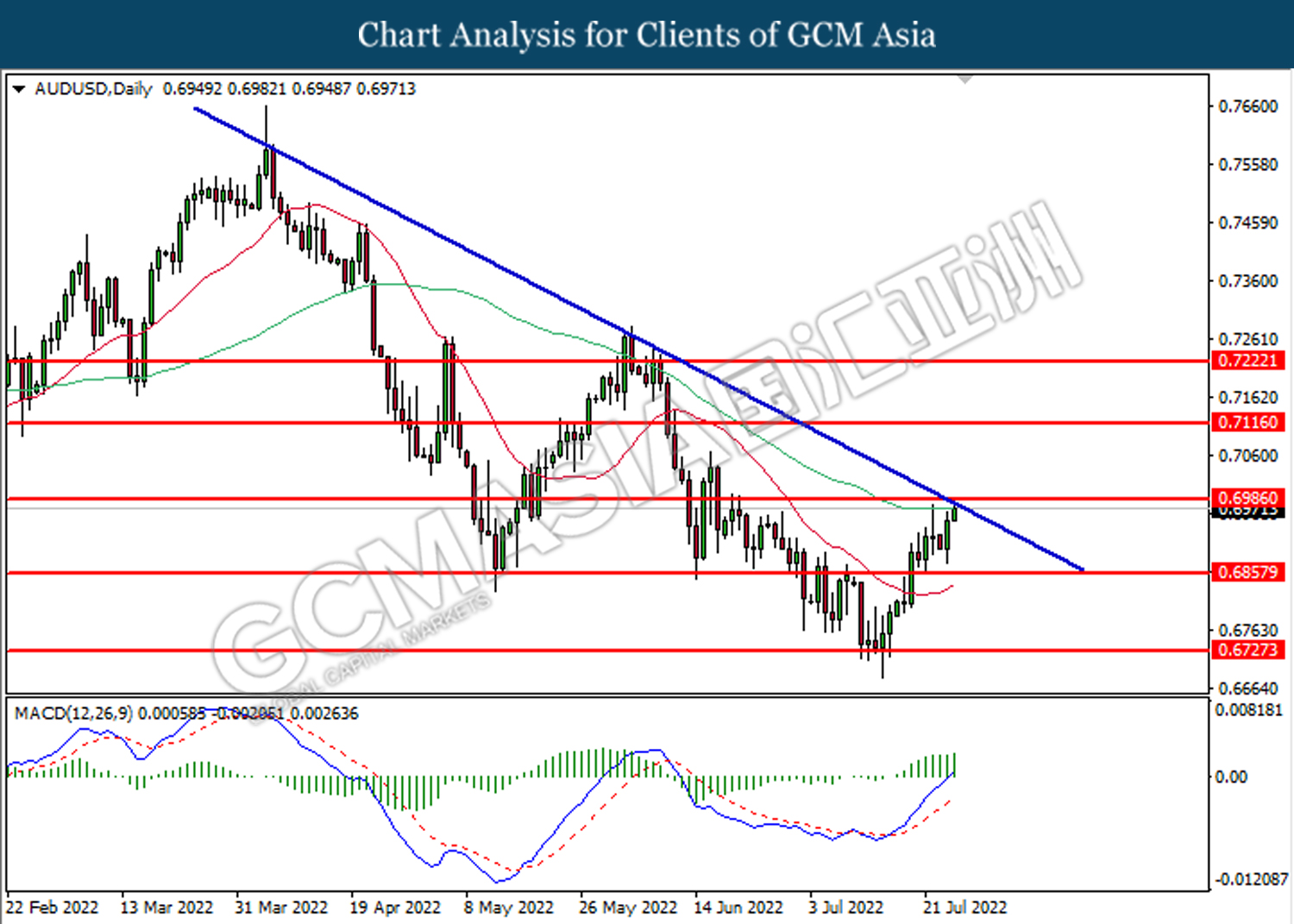

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

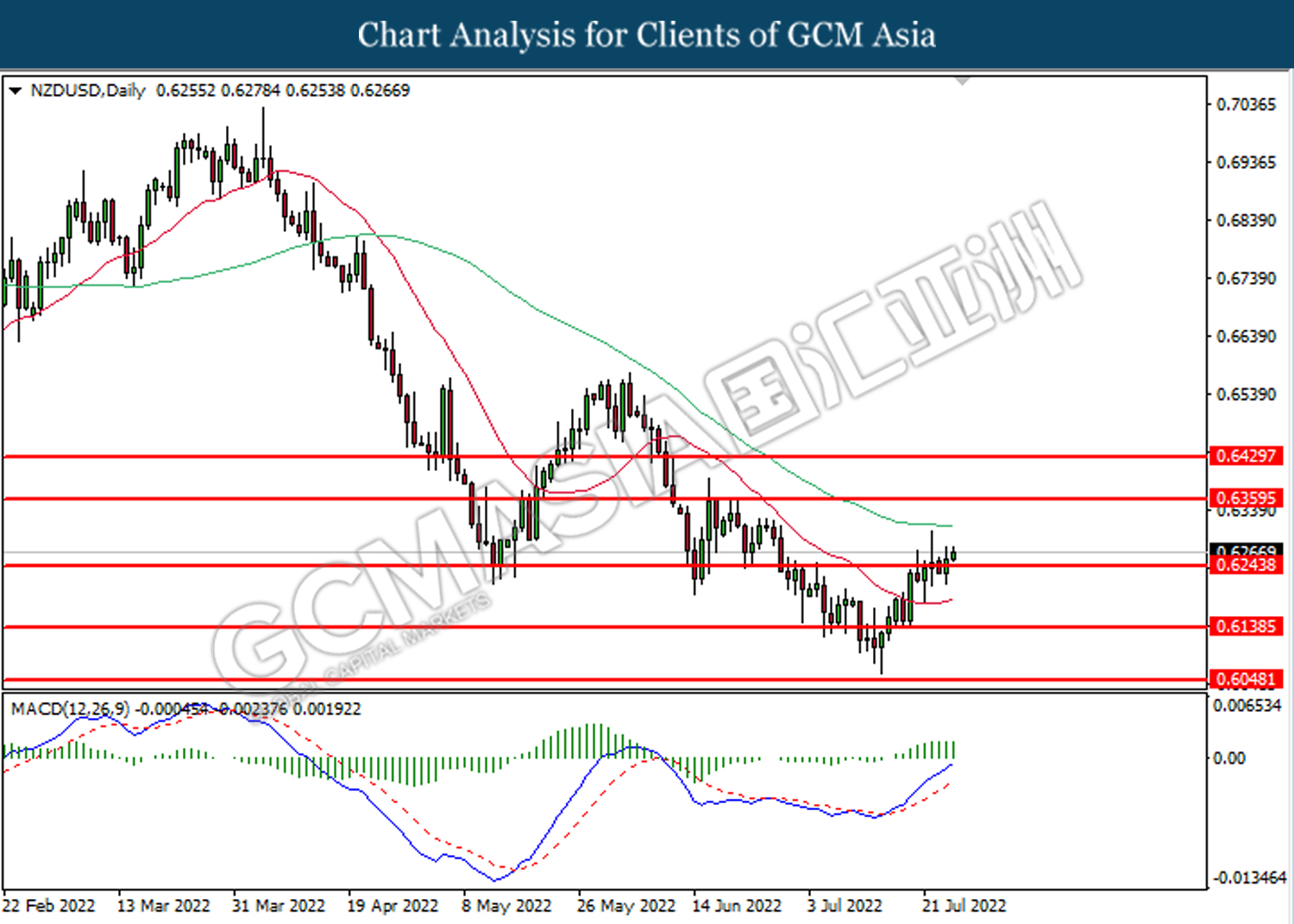

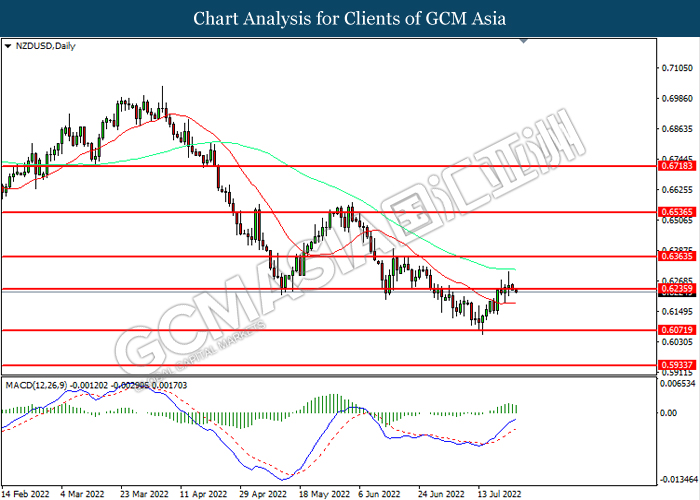

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

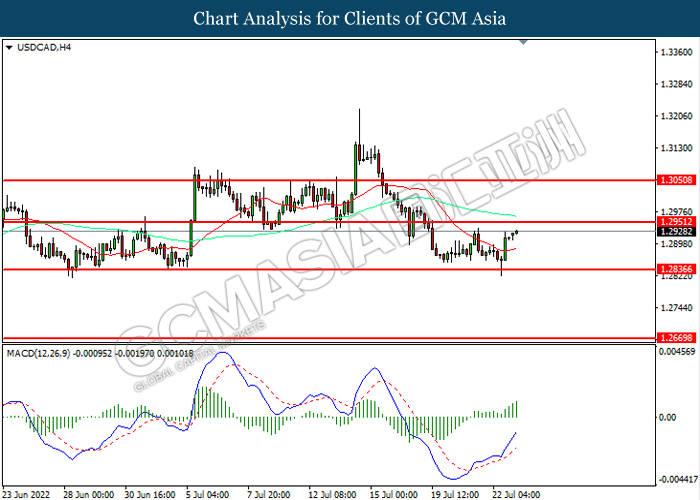

USDCAD, H4: USDCAD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2825.

Resistance level: 1.2925, 1.2985

Support level: 1.2825, 1.2755

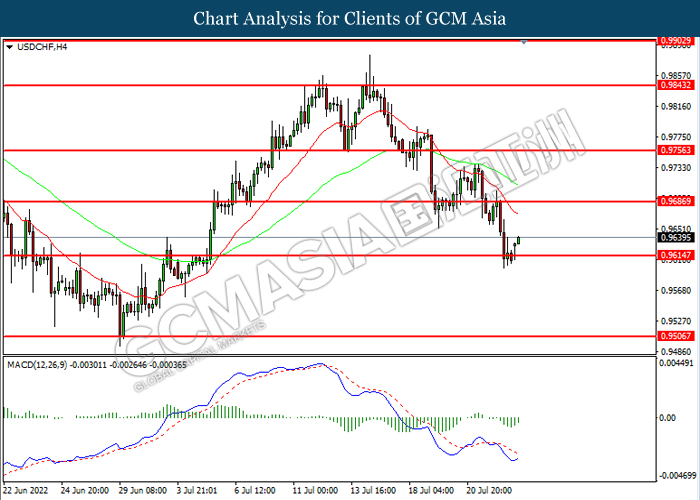

USDCHF, Daily: USDCHF was traded lower while currently retesting the upward trendline. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1729.25. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80

260722 Afternoon Session Analysis

26 July 2022 Afternoon Session Analysis

Euro jumped as a large rate hike could be expected soon after.

The euro, which is widely traded by investors worldwide, surged following the increasing possibility of a big rate hike. According to the member of the ECB, Latvian central bank governor Martins Kazaks revealed that the large rate hike may not be over yet, after raising its interest rate by 50 basis points last week. However, he also reiterated that no clear forward guidance would be given at this point of time, but the rate increase in September also needs to be quite significant. Nevertheless, the gains of the single currency were limited after downbeat data was released from the Eurozone. According to the ifo Institute for Economic Research, the Germany ifo Business Climate Index declined from 92.2 to 88.6, missing the consensus forecast of 90.2. With that, it shows that the current German business environment remains clouded, while the outlook is blurred. As of writing, the pair of EUR/USD is up by 0.18% to 1.0238.

In the commodities market, the crude oil price up 0.93% to $97.70 a barrel amid the Russia-Ukraine war heightened. Yesterday, Russia fired a few missiles to Ukraine’s Odesa port, one day after the grain export deal had been achieved between these two countries. Besides, the gold prices went up 0.36% to $1725.80 a troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jul) | 98.7 | 97.3 | – |

| 22:00 | USD – New Home Sales (Jun) | 696K | 664K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated increasing bearish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2035. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2175.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 136.65. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 136.65, 137.60

Support level: 135.25, 133.15

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2775

USDCHF, Daily: USDCHF was traded lower while currently retesting the upward trendline. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 98.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80

260722 Morning Session Analysis

26 July 2022 Morning Session Analysis

US Dollar slipped over the bearish economic progression.

The Dollar Index which traded against a basket of six major currencies slipped on Monday over the expectation of economy slowdown from the US officials, which spurred bearish momentum on the US Dollar. According to Reuters, the US Treasury Secretary Janet Yellen claimed on Sunday that the economic growth was slowing, a recession was not inevitable. The pessimistic economic outlook of US had prompted investors to shift their capitals toward other currencies which having better prospects. Nonetheless, the movement of Dollar Index was relatively slower as investors are eyeing on the interest rate decision from Federal Reserve. As of now, Fed is widely expected to raise its interest rate by 75 basis point in the upcoming Thursday meeting. Two weeks ago, part of the market participant were predicting that the Fed would implement an aggressive 1% rate hike after the CPI data was released. As of writing, the Dollar Index depreciated by 0.27% to 106.33.

In the commodities market, the crude oil price eased by 0.37% to $96.34 per barrel as of writing. However, the oil price surged on yesterday trading session which was benefited from the weakening US Dollar. On the other hand, the gold price depreciated by 0.10% to $1717.30 per troy ounce as of writing following the rising expectation of rate hike from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jul) | 98.7 | 97.3 | – |

| 22:00 | USD – New Home Sales (Jun) | 696K | 664K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.55

Support level: 105.25, 103.65

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85

250722 Afternoon Session Analysis

25 July 2022 Afternoon Session Analysis

A series of upbeat data ignited optimism in Pound market.

The British Pound, which was majorly traded by the global investors, jumped as a series of positive economic data showed that the economic condition in UK remains bright and resilient. According to the Office for National Statistics, UK Retail Sales data increased from the prior month reading of -0.8% to -0.1%, while stronger than the consensus forecast at -0.3%. It indicated that the deterioration of the consumer spending in UK has eased slightly. Besides, other data such as UK Composite PMI, Manufacturing PMI and Services PMI also came in at a reading which higher than the consensus forecast respectively, where it further cemented the view that UK economic condition has started to turn around from the worst. With such as backdrop, it has lit up the market expectation on aggressive rate hike by Bank of England in the upcoming meeting. As of writing, the pair of GBP/USD dropped -0.09% to 1.1991.

In the commodities market, the crude oil price up 1.75% to $93.75 a barrel after the European Union allow Russian state-owned companies to ship oil to third countries, which would help to ease the global oil supply tightness. Besides, the gold prices up 0.06% to $1726.80 a troy ounce amid weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Jul) | 92.3 | 90.2 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated increasing bearish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2035, 1.2175

Support level: 1.1900, 1.1800

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 136.65. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.65, 137.60

Support level: 135.25, 133.15

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6855.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6245. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6140.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2910. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2975.

Resistance level: 1.2975, 1.3050

Support level: 1.2910, 1.2835

USDCHF, H4: USDCHF was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 91.80.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80

250722 Morning Session Analysis

25 July 2022 Morning Session Analysis

US Dollar slumped amid concerns upon the recession risk.

The Dollar Index which traded against a basket of six major currencies extend its losses on last Friday over the backdrop of bearish economic data as well as the pessimistic statement from Janet Yellen. On the economic data front, US Services Purchasing Managers Index (PMI) notched down significantly from the previous reading of 52.7 to 47.0, missing the market forecast at 52.6. Such downbeat reading had indicated that currently the US business activity had contracted for the first time in nearly two years as the high inflation risk, rising interest rates as well as deteriorating consumer confidence continue to jeopardize the economic growth in the United States. Besides that, US Treasury Secretary Janet Yellen warned that the US economic growth is slowing down while she acknowledged the risk of a recession continue to linger in the global financial market. In addition, the data last week suggested the labor market was softening with new claims for the unemployment benefits hitting the highest reading in eight months. Besides, she also reiterated that the inflation rate is way too high and she hoped the Federal Reserve could stabilize the further inflation risk in future without triggering a broad economic downturn. As of writing, the Dollar Index depreciated by 0.13% to 106.60.

In the commodities market, the crude oil price slumped 0.03% to $95.35 per barrel as of writing amid the global recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold price appreciated by 0.02% to $1725.30 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Jul) | -0.50% | -0.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | – | 0.25% | – |

| 20:30 | USD – Initial Jobless Claims | 244K | 240K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -3.3 | -2.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 108.15, 109.05

Support level: 106.40, 105.55

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2035, 1.2155

Support level: 1.1920, 1.1830

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its toward resistance level.

Resistance level: 1.0270, 1.0385

Support level: 1.0160, 1.0085

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 140.95, 144.60

Support level: 131.85, 126.75

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6950, 0.7030

Support level: 0.6850, 0.6720

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2950, 1.3050

Support level: 1.2835, 1.2670

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9685, 0.9755

Support level: 0.9615, 0.9505

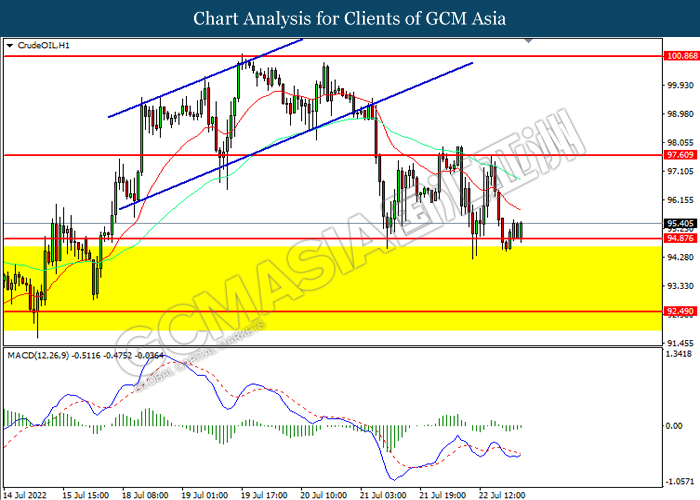

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 97.60, 100.85

Support level: 94.85, 92.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction

Resistance level: 1725.00, 1745.65

Support level: 1702.60, 1680.00

220722 Afternoon Session Analysis

22 July 2022 Afternoon Session Analysis

Downbeat economic data beaten down the US Dollar.

The dollar index, which traded against a basket of six major currencies plunged following the release of a series of downbeat economic data. According to the Department of Labor, US Initial Jobless Claims came in at 251K, higher than the consensus forecast at 240K, showing the labor market in the US remain fragile. The higher-than-expected number of American filing for unemployment claims could be mainly attributed to the increasing number of employee layoff in most of the US giants. On the other hand, US Philadelphia Fed Manufacturing Index has also shown that the general business conditions in the manufacturing sector has deteriorated, where the actual reading came in at -12.3, far weaker than the consensus forecast at -2.5. A series of downbeat data prompted the investors to shift their capital from the dollar index to other appealing market. At this juncture, the market attentions have been gathered at the upcoming Fed meeting in order to gauge the further direction of the currency. As of writing, the dollar index dropped 0.07% to 106.85.

In the commodities market, the crude oil price up 0.79% to $97.55 a barrel as the depreciation of US dollar limited the losses of the crude oil, while the oil production capacity of OPEC+ has hit the maximum level. Besides, the gold prices eased by 0.16% to $1715.60 per troy ounce, while the dollar index edged up following a correction yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | -0.5% | -0.4% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul | 52.0 | 51.0 | – |

| 16:30 | GBP – Composite PMI | 53.7 | – | – |

| 16:30 | GBP – Manufacturing PMI | 52.8 | – | – |

| 16:30 | GBP – Services PMI | 54.3 | – | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | 1.3% | 0.6% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated increasing bearish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.1900. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2035.

Resistance level: 1.2035, 1.2175

Support level: 1.1895, 1.1800

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0170

Support level: 1.0155, 1.0075

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 137.60. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 137.60, 138.00

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, H4: USDCAD was traded higher following prior rebound from the upward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2910.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2775

USDCHF, H4: USDCHF was traded higher while currently retesting the resistance level at 0.9675. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the prior support level at 98.20. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80

220722 Morning Session Analysis

22 July 2022 Morning Session Analysis

Euro surged upon aggressive rate hikes from ECB.

The EUR/USD, which traded by majority of investors rose significantly on yesterday after European Central Bank (ECB) announced its interest rate decision. According to the meeting last night, ECB decided to raise its interest rate for the first time in 11 years by 50 basis point, which exceeding the market forecast of 0.25% rate hikes. The current rate hikes has ended negative rates era in Eurozone. Besides, the ECB claimed that it was a proper way to take more forcefully rate hikes in order to tame the soaring inflation, which sparkling the appeal of Euro. The ECB also reiterated that this move in interest rates will support the return of inflation to the Governing Council’s medium-term target by strengthening the anchoring of inflation expectations and ensuring that demand conditions adjust to meet the medium-term inflation target. The central bank’s inflation target is 2%. As of writing, EUR/USD edged down by 0.01% to 1.0227.

In the commodities market, crude oil price depreciated by 0.02% to $96.33 per barrel as of writing following the returning oil supply from Libya and the resumption of Russia’s gas flow to Europe eased supply concerns. On the other hand, gold price appreciated by 0.23% to $1717.30 per troy ounce as of writing amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | -0.5% | -0.4% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul | 52.0 | 51.0 | – |

| 16:30 | GBP – Composite PMI | 53.7 | – | – |

| 16:30 | GBP – Manufacturing PMI | 52.8 | – | – |

| 16:30 | GBP – Services PMI | 54.3 | – | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | 1.3% | 0.6% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.80

Support level: 105.25, 103.65

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2030, 1.2170

Support level: 1.1870, 1.1725

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2940, 1.3035

Support level: 1.2875, 1.2800

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85

210722 Afternoon Session Analysis

21 July 2022 Afternoon Session Analysis

Japanese Yen remained weak following monetary policy decision.

The overall market demand toward the Japanese Yen remained weak following the Bank of Japan maintain their easy monetary policy on Thursday, while it predicts more consumer inflation a higher commodity price worldwide. According to the latest monetary policy statement, the Japanese Central Bank decided to keep its monetary policy interest rate unchanged, controlling the 10-year yields to zero while short-term rates to minus 0.1% and promising to continue purchasing Japanese government bond without limit. Though, the losses experienced by the Japanese Yen was limited following the central bank increase the inflation forecast. the BoJ’s Monetary Policy Committee (MPC) predicted that the consumer inflation would rise 2.3% for the fiscal current year, increase from a 1.9% forecast three months ago. Rising inflation expectation would likely to prompt the central bank the increase their interest rate in future in order to stabilize the inflation risk. As of writing, USD/JPY appreciated by 0.01% to 138.20.

In the commodities market, the crude oil price retreated by 1.02% to $98.85 per barrel as of writing. The crude oil price slumped following the US gasoline inventories rose to 3.5-million-barrel last week, according to the government data, far higher than the market forecast at 71,000 barrels. On the other hand, the gold price depreciated by 0.21% to $1693.00 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Jul) | -0.50% | -0.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | – | 0.25% | – |

| 20:30 | USD – Initial Jobless Claims | 244K | 240K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -3.3 | -2.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 108.15, 109.05

Support level: 106.40, 105.55

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2035, 1.2155

Support level: 1.1940, 1.1830

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its toward resistance level.

Resistance level: 1.0270, 1.0385

Support level: 1.0160, 1.0085

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 140.95, 144.60

Support level: 131.85, 126.75

AUDUSD, H4: AUDUSD was traded higher following rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6950, 0.7030

Support level: 0.6850, 0.6720

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2950, 1.3050

Support level: 1.2835, 1.2670

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9755, 0.9845

Support level: 0.9685, 0.9615

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 100.85, 104.75

Support level: 97.40, 92.50

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1702.60, 1725.00

Support level: 1680.00, 1666.85

210722 Morning Session Analysis

21 July 2022 Morning Session Analysis

Euro beaten down amid the raising risk of energy crisis.

The Euro which was traded by majority of investors eased on yesterday amid the rising odds of diminishing gas supply. According to Reuters, the Russia President Vladimir Putin had warned that Russian’s gas supplies sent via the Nord Stream 1 pipeline to Europe could be reduced further and might even stop. Thus, the European Commission proposed to reduce gas usage by 15% until next spring as an emergency step. The disruptions have hampered Europe’s efforts to refill gas storage before winter, raising the risk of rationing and another hit to fragile economic growth if Moscow further restricts flows in retaliation for Western sanctions over the war in Ukraine. The move from Russia had dialed down the market optimism toward economic progression in Europe. Besides, investors would continue to scrutinize the latest updates with regards of interest rate decision from ECB which will be released tonight in order to receive further trading signals. As of writing, EUR/USD edged down by 0.01% to 1.0177.

In the commodities market, crude oil price depreciated by 0.24% to $99.64 per barrel as of writing after the US government data showed lower gasoline demand during the peak summer driving season. On the other hand, gold price depreciated by 0.44% to $1692.65 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Outlook Report (YoY)

TBC JPY BoJ Press Conference

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 20:15 | EUR – Deposit Facility Rate (Jul) | -0.50% | -0.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | – | 0.25% | – |

| 20:30 | USD – Initial Jobless Claims | 244K | 240K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -3.3 | -2.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.80

Support level: 105.25, 103.65

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2030, 1.2170

Support level: 1.1870, 1.1665

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2940, 1.3035

Support level: 1.2875, 1.2800

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1700.95, 1718.90

Support level: 1681.85, 1664.95

200722 Afternoon Session Analysis

20 July 2022 Afternoon Session Analysis

RBA targeted aggressive rate hikes, AUD/USD surged.

The AUD/USD was traded higher throughout the yesterday trading session amid the rising expectations of rate hike from Australia’s central bank. According to Reuters, Reserve Bank of Australia (RBA) Governor Philip Lowe appeared a speech at a business conference in Melbourne, said that the spiking inflation should not feed through to business and household expectations. He recommended that the rate increases could at least double from current low levels, which might need a rate hike from the current 1.35% to a neutral level of at least 2.5% in order to tackle inflation which reached to a 20-year peak of 5.1%. Few weeks ago, the RBA had raised its interest rate for three months consecutively while the market participants are predicting a further rate hike to 3.5% by the end of the year, which sparkling the appeal of the Australia Dollar. Besides, the Australia Dollar extended its gains over the slump of the US Dollar. As of writing, AUD/USD edged up by 0.06% to 0.6899.

In the commodities market, crude oil price depreciated by 0.46% to $100.30 per barrel as of writing as the rising number of Covid-19 cases in China would hit world demand for oil. On the other hand, gold price depreciated by 0.13% to $1708.50 per troy ounce as of writing following the heightened expectations of rate hikes from major central banks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Jun) | 9.1% | 9.2% | – |

| 20:30 | CAD – Core CPI (MoM) (Jun) | 0.8% | – | – |

| 22:00 | USD – Existing Home Sales (Jun) | 5.41M | 5.38M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.80

Support level: 105.25, 103.65

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2115, 1.2175

Support level: 1.2010, 1.1870

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0315, 1.0385

Support level: 1.0235, 1.0145

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85

200722 Morning Session Analysis

20 July 2022 Morning Session Analysis

ECB signalled bigger rate hike expectation, Euro rebounded.

The Euro received significant bullish momentum yesterday following the European Central Bank signaled a bigger rate hike to stabilize the inflation risk for the European economy. According to Reuters, the European Central Bank policymakers are currently considering to increase their interest rate by bigger-than-expected 50 basis point during their monetary policy meting on Thursday. Besides, the policymakers also claimed that they would announce a deal to assist indebted countries like Italy on the bond market in order to cushion the impact of the higher borrowing cost. Nonetheless, the risk of a recession in the Euro zone continue to linger in the global financial market as the rising tensions between Russia-Ukraine issues would prompt the Russia to reduce natural gas supplies to Europe countries. Recently, the Euro zone inflation hit 8.6% last month and economist expected the inflation rate could keep rising until the autumn. The energy crisis in European region would add further tensions toward the living costs for the countries. As of writing, EUR/USD appreciated by 0.11% to 1.0235.

In the commodities market, the crude oil price appreciated by 0.02% to $100.45 per barrel as of writing following the US Dollar retreats into two-week low, making oil less expensive for buyers using other currencies. On the other hand, the gold price was traded flat at $1712.05 per troy ounces as of writing as market participants waited for crucial monetary policy meeting from Federal Reserve before entering the gold market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Jun) | 9.1% | 9.2% | – |

| 20:30 | CAD – Core CPI (MoM) (Jun) | 0.8% | – | – |

| 22:00 | USD – Existing Home Sales (Jun) | 5.41M | 5.38M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 108.15, 109.05

Support level: 106.40, 105.55

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2035, 1.2155

Support level: 1.1940, 1.1830

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0270, 1.0385

Support level: 1.0160, 1.0085

USDJPY, H4: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 139.65, 142.75

Support level: 137.75, 135.10

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6950, 0.7030

Support level: 0.6850, 0.6720

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2950, 1.3050

Support level: 1.2835, 1.2670

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9755, 0.9845

Support level: 0.9685, 0.9615

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 100.85, 104.75

Support level: 97.40, 92.50

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1724.95, 1745.65

Support level: 1702.60, 1679.25

190722 Afternoon Session Analysis

19 July 2022 Afternoon Session Analysis

Australia Dollar surged amid hawkish expectation.

The Australia Dollar extends its gains following the Reserve Bank of Australia unleashed their hawkish tone toward the economic progression in the Australia region. According to the latest monetary policy meeting minutes, the Reserve Bank of Australia has signaled the need for higher rate hikes in order to combat the spiking inflation risk. Despite the recent rate hikes which adding further pressure toward the Australia economy, the unemployment drops to its lowest level in nearly 50 years. The Reserve Bank of Australia (RBA) also sees the current benchmark rate of 1.35% is still well below the neutral rate. Currently, if the Australia economy continue to its full recovery, market participants could expect the Reserve Bank of Australia would likely to increase further benchmark rate by 0.75% in August. Inflation figures are currently the most crucial indicator to determine the future monetary policy, hence investors would continue to scrutinize further data to gauge the likelihood movement for the currency. As of writing, AUD/USD appreciated by 0.56% to 0.6850.

In the commodities market, the crude oil price surged 0.14% to $99.10 per barrel as of writing. The crude oil price was traded higher as the recent depreciation of US Dollar continue to spark further demand on this greenback-dominated oil. On the other hand, the gold price slumped 0.03% to $1709.70 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (May) | 6.8% | 6.9% | – |

| 14:00 | GBP – Claimant Count Change (Jun) | -19.7K | – | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 8.6% | 8.6% | – |

| 20:30 | USD – Building Permits (Jun) | 1.695M | 1.650M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level.

Resistance level: 1.2035, 1.2155

Support level: 1.1940, 1.1830

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0160, 1.0270

Support level: 1.0085, 1.0000

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 139.65, 142.75

Support level: 137.75, 134.45

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6850, 0.6950

Support level: 0.6720, 0.6615

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2985, 1.3050

Support level: 1.2915, 1.2840

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9845, 0.9905

Support level: 0.9755, 0.9685

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 95.20, 103.40

Support level: 95.15, 89.50

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1724.95, 1745.65

Support level: 1702.60, 1679.25

190722 Morning Session Analysis

19 July 2022 Morning Session Analysis

Bullish financial report announced, US Dollar slumped.

The Dollar Index which traded against a basket of six major currencies dropped significantly amid the backdrop of upbeat financial performance from banks. According to Reuters, Bank of America Corp beat analysts’ estimates for second-quarter profit on Monday, with healthy consumer spending and strong demand for loans limiting the hit from its investment banking business. On the other hand, Goldman Sachs Group Inc also beat expectations, its stock rising more than 4% after bond trading helped overcome weakness in M&A advisory. The greater-than-expected performance had dialed up the market optimism toward the company development, which stoked a shift in sentiment toward risk-appetite assets such as stocks market. However, the losses experienced by the Dollar Index was limited after the tech giant company released its financial report. Apple shares fell 2% after a report claimed that it would slow hiring and spending, becoming the latest tech giant to make such a move as fears of an economic downturn hit the sector. As of writing, the Dollar Index depreciated by 0.58% to 107.28.

In the commodities market, crude oil price eased by 0.45% to $98.97 per barrel as of writing. Nonetheless, the oil price surged on yesterday as no announcements on increasing oil production by the Saudis. Besides, gold price depreciated by 0.29% to $1705.20 per troy ounce as of writing over the appreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (May) | 6.8% | 6.9% | – |

| 14:00 | GBP – Claimant Count Change (Jun) | -19.7K | – | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 8.6% | 8.6% | – |

| 20:30 | USD – Building Permits (Jun) | 1.695M | 1.650M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses id successfully breakout the support level.

Resistance level: 108.80, 110.50

Support level: 107.30, 105.25

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0145, 1.0235

Support level: 1.0040, 0.9950

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85

180722 Afternoon Session Analysis

18 July 2022 Afternoon Session Analysis

Inflation risk continue to spur hawks’ sentiment in NZD.

The New Zealand Dollar surged significant following the released of spiking inflation data, which spurring further expectation upon the rate hike policy from the Reserve Bank of New Zealand. According to Statistics New Zealand, New Zealand Consumer Price Index (CPI) quarter-on-quarter came in at 1.7%, exceeding the market forecast at 1.5% and annual rate increment by 7.1%. Recently, the Reserve Bank of New Zealand (RBNZ) has increased their interest rate to 2.50% from a record low 0.25% in October last year. Besides, the Monetary Policy Committee (MPC) also signaled that further rate hikes would be needed in order to combat the high inflation risk. Nonetheless, the gains experienced by the Chinese proxy currency such as New Zealand Dollar was limited following cities across China had implement partial Covid-19 lockdown. In total, China reported another 450 new Covid-19 cases on Friday, according to the National Health Commission. As of writing, NZD/USD appreciated by 0.49% to 0.6190.

In the commodities market, the crude oil price retreated by 0.85% to $93.90 per barrel as of writing. The crude oil price edged higher amid market participants concerned that the implementation of lockdown in China would weigh down the market demand on this black commodity. On the other hand, the gold price appreciated by 0.36% to $1713.45 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level.

Resistance level: 1.2035, 1.2190

Support level: 1.1815, 1.1655

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level.

Resistance level: 1.0160, 1.0385

Support level: 1.0000, 0.9780

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 139.65, 142.75

Support level: 137.75, 134.45

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6850, 0.7030

Support level: 0.6720, 0.6615

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9750, 0.9845

Support level: 0.9685, 0.9615

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it breakout the resistance level.

Resistance level: 95.15, 103.40

Support level: 89.50, 84.05

GOLD_, H1: Gold price was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1724.95, 1745.65

Support level: 1702.60, 1679.25