180722 Morning Session Analysis

18 July 2022 Morning Session Analysis

Investors lowered Fed’s rate hike forecast, US Dollar beaten down.

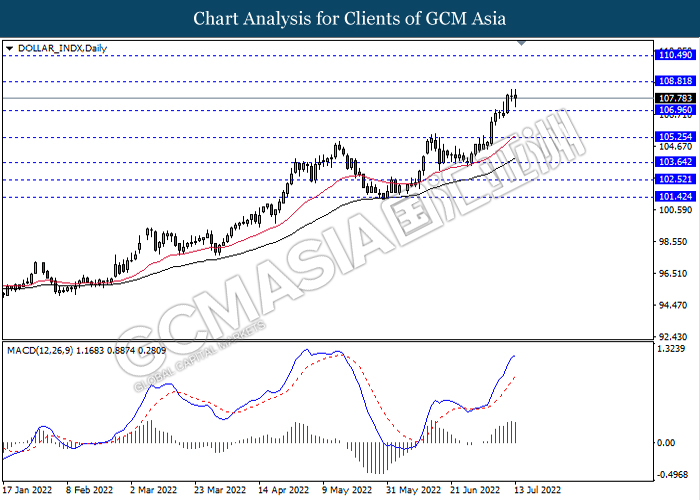

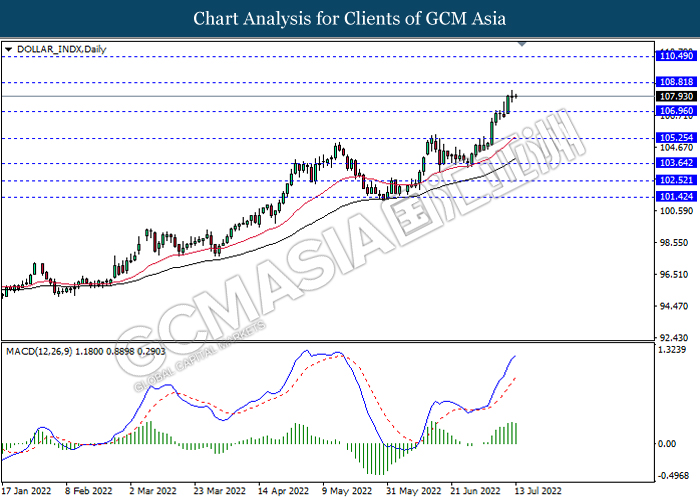

The Dollar Index which traded against a basket of six major currencies retreated from its recent high on Friday over the diminishing odds of aggressive rate hikes from Federal Reserve. According to Fed Rate Monitor Tool, the possibility of 100 basis point increase was notched down from the previous day’s reading of 48.2% to 29.1%. Last week, the CPI and PPI data had given a higher-than-expected reading, which are 9.1% and 1.1% respectively. These inflation data which over the market forecast had hinted that the risk of increasing price keep lingering in the US market while the market participants started to ponder a full-percentage point of rate hike. Nonetheless, two of the Federal Reserve’s most hawkish policymakers on 14 July said they favored another 75-basis-point interest rate increase at the US central bank’s policy meeting this month, which spurred bearish momentum on the US Dollar. As of writing, the Dollar Index depreciated by 0.14% to 107.76.

In the commodities market, crude oil price edged down by 0.13% to $94.44 per barrel as of writing. However, the oil price rebounded on the last Friday trading session as the immediate Saudi oil output boost was not expected, according to Reuters. On the other hand, gold price appreciated by 0.27% to $1708.25 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

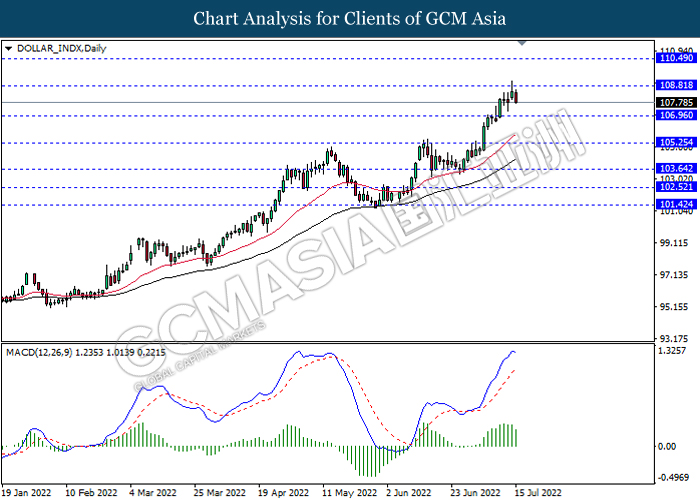

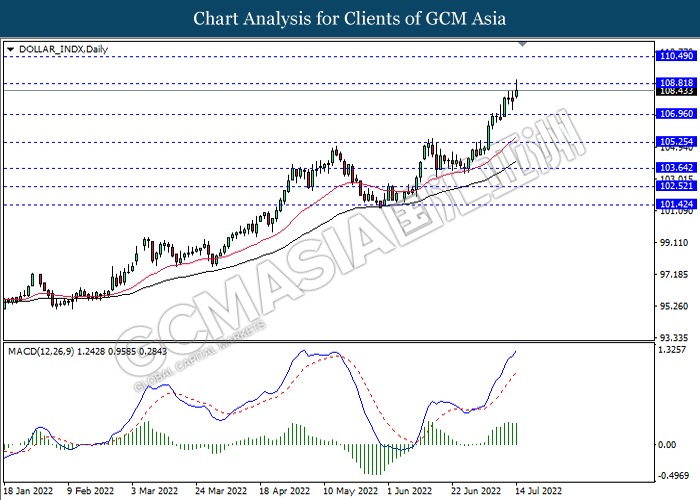

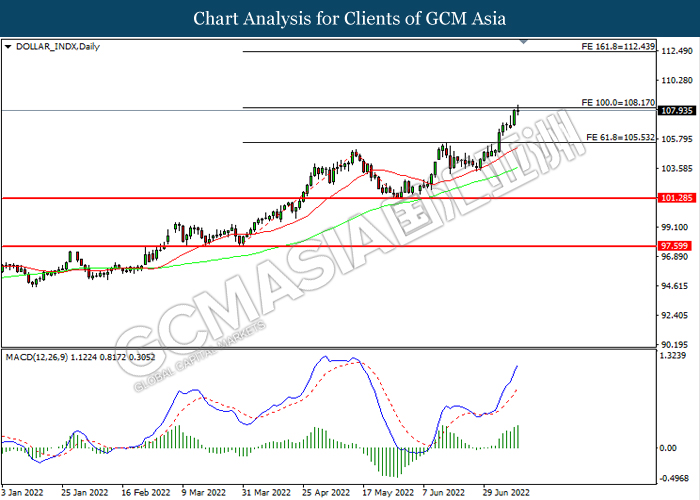

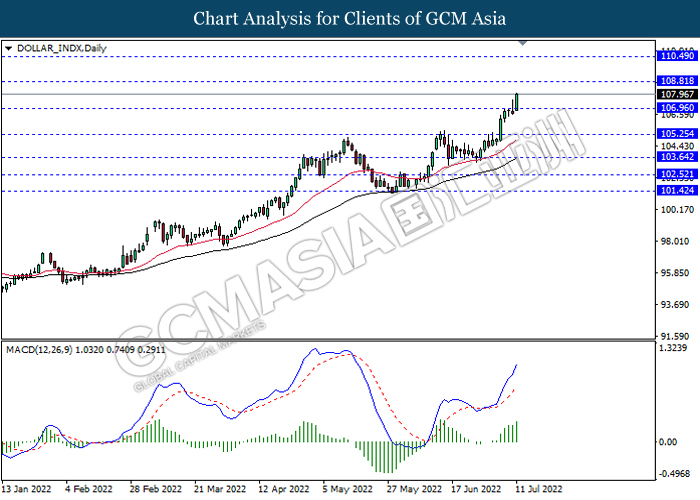

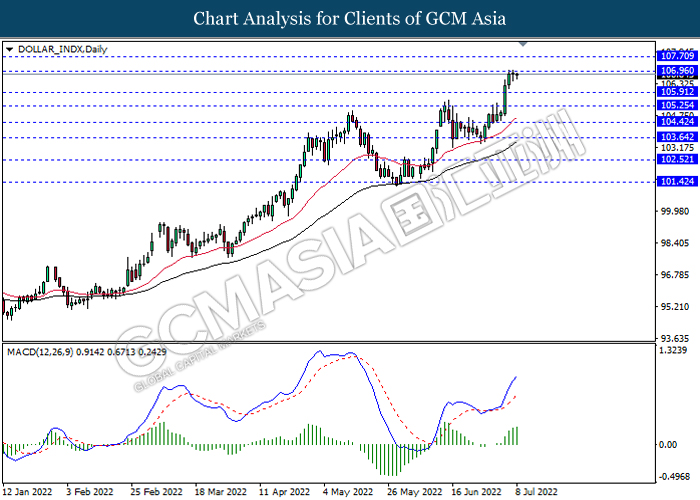

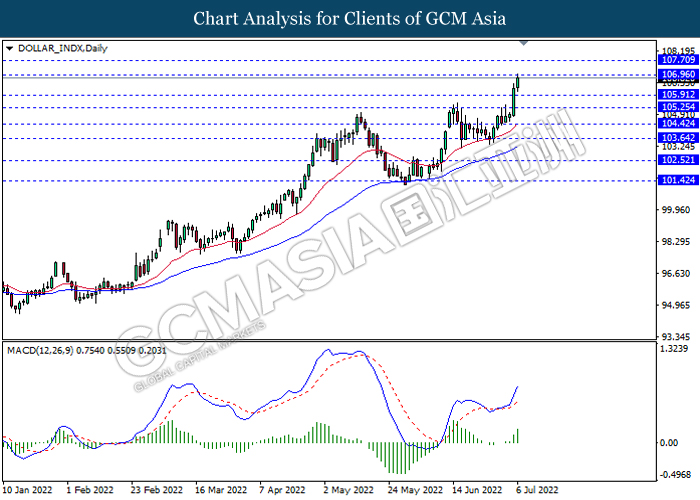

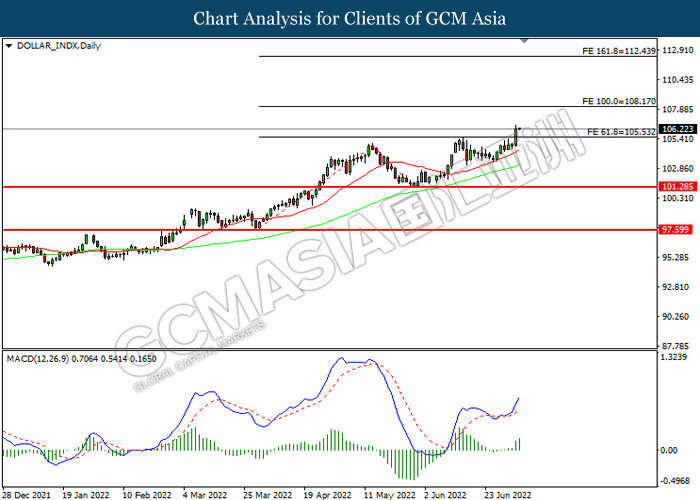

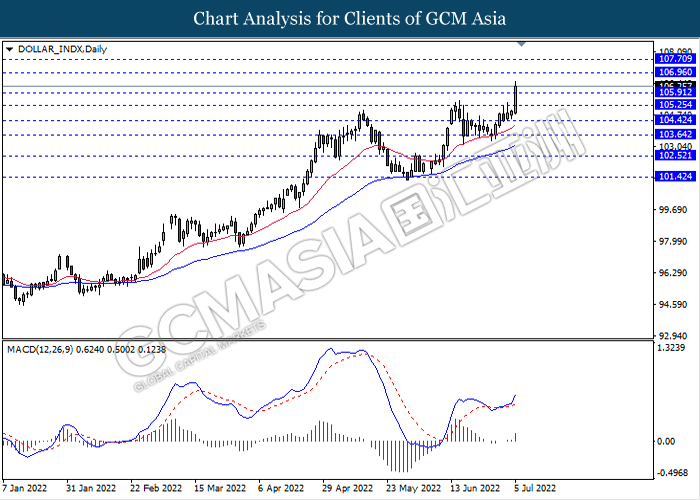

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

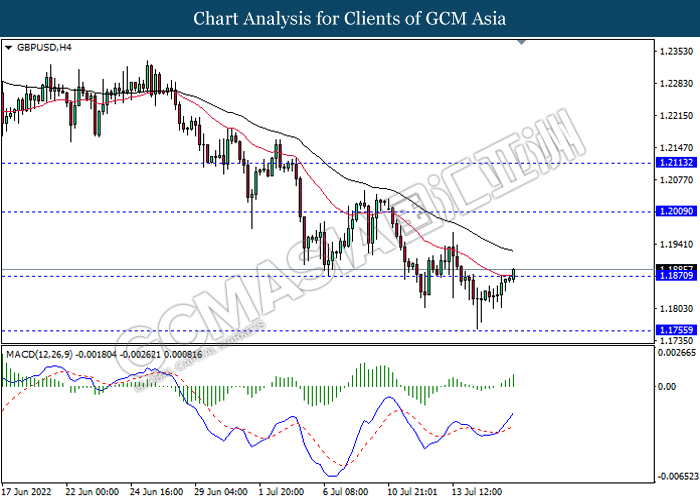

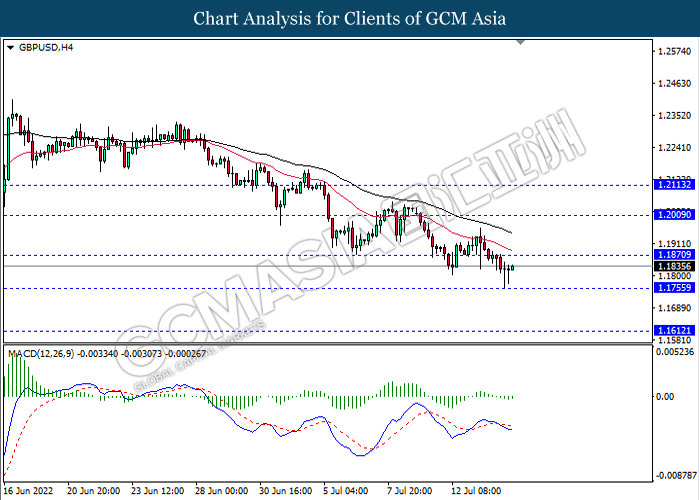

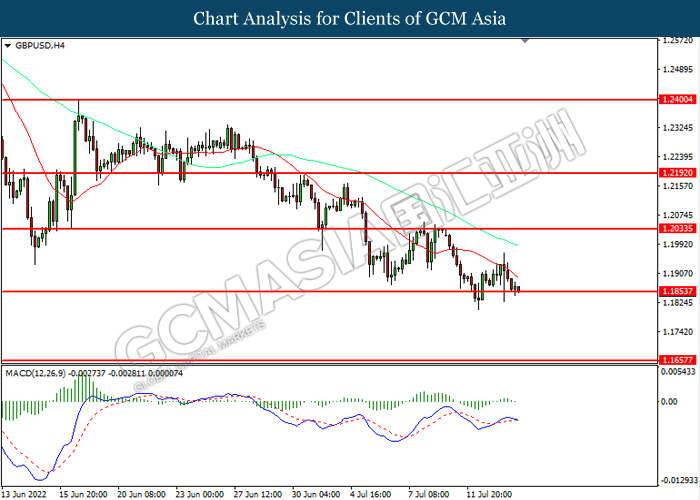

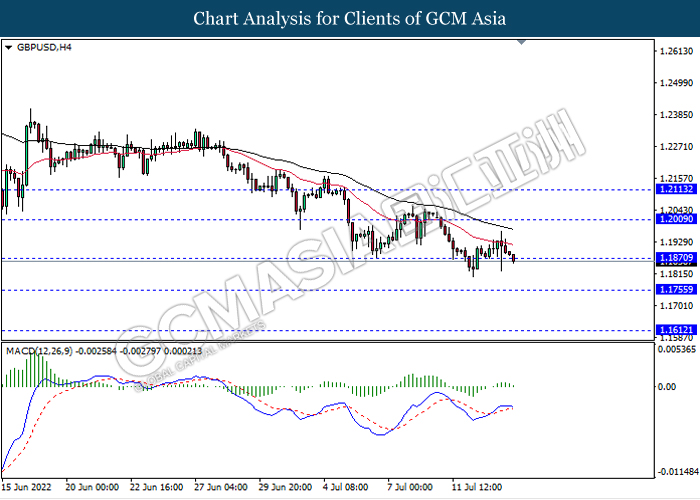

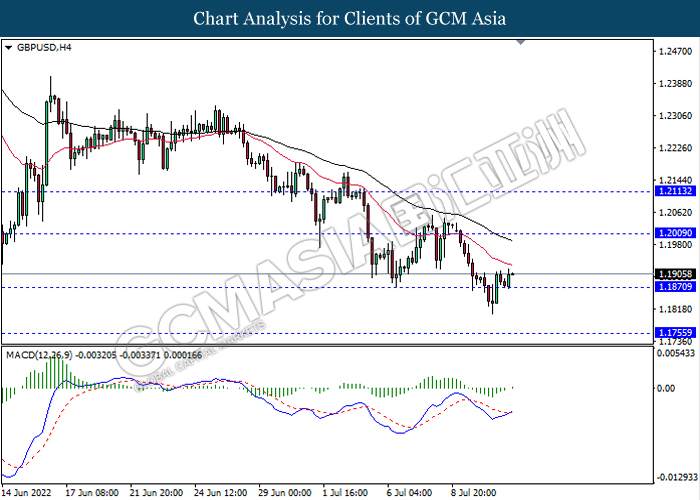

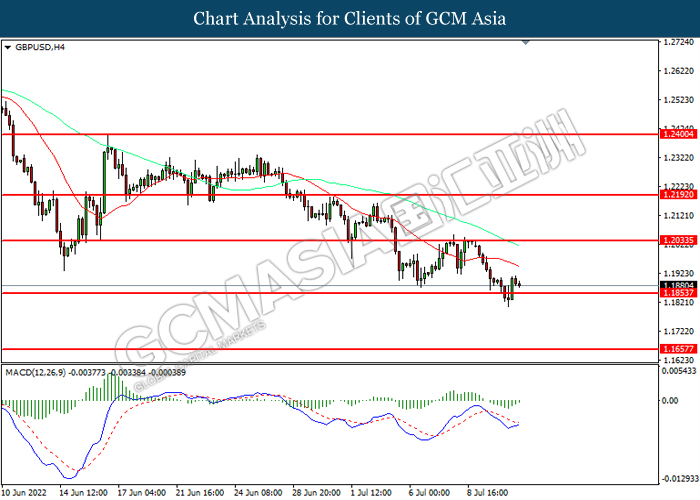

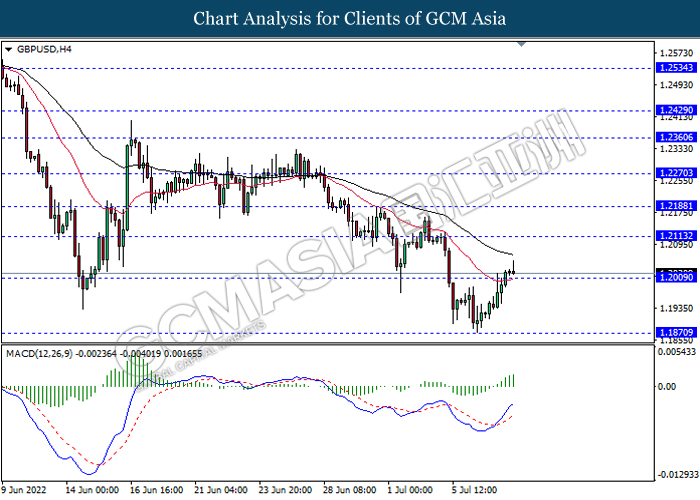

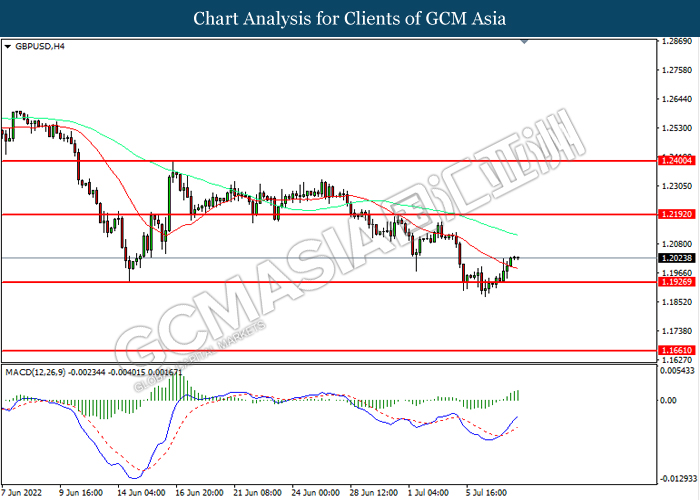

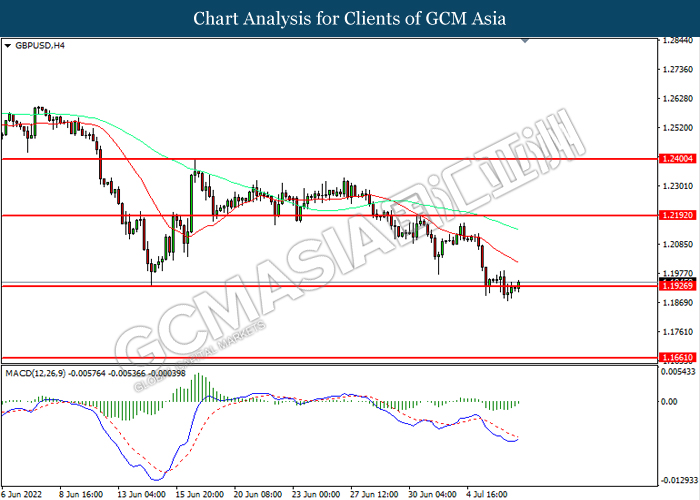

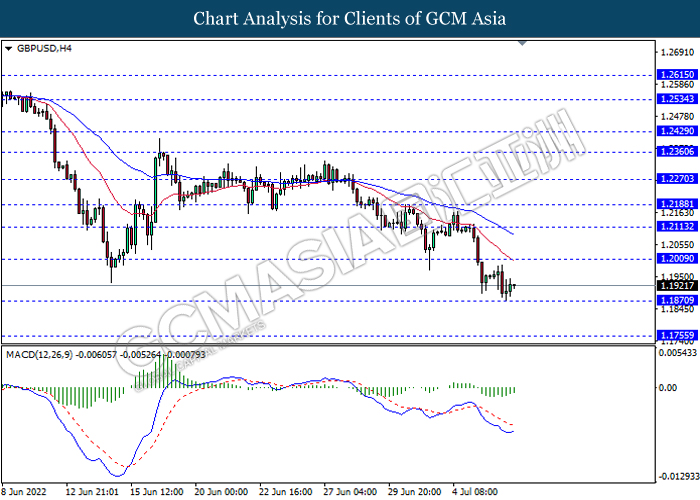

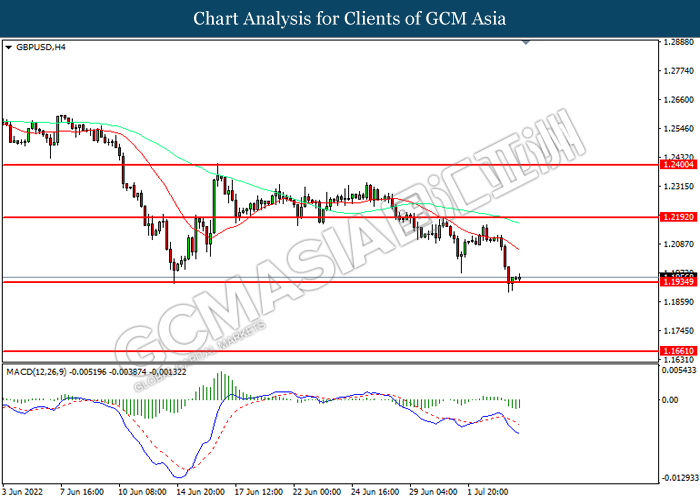

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

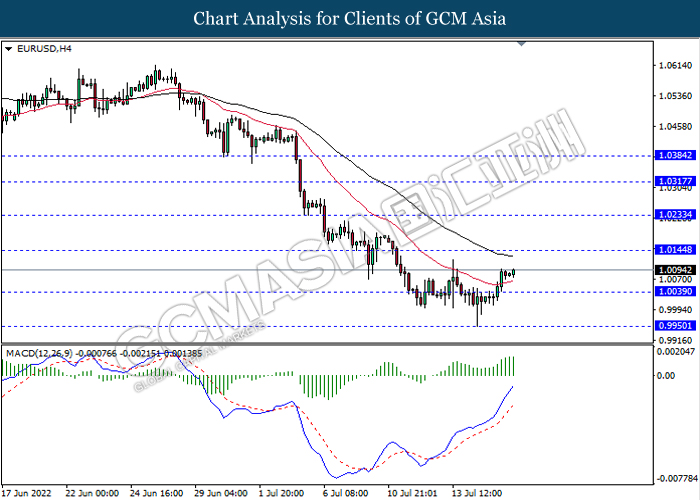

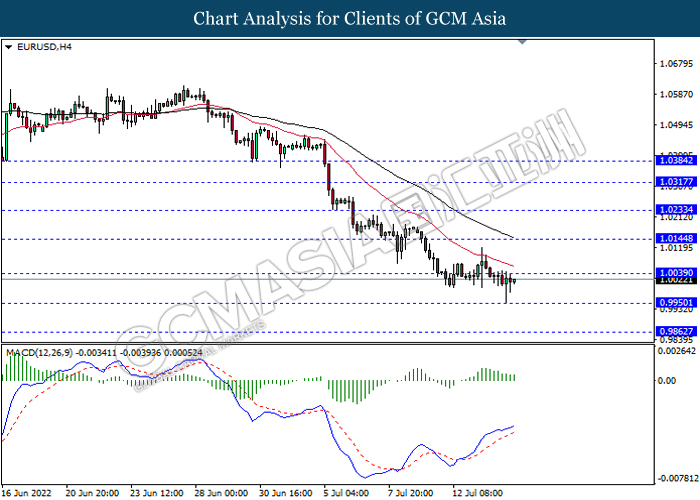

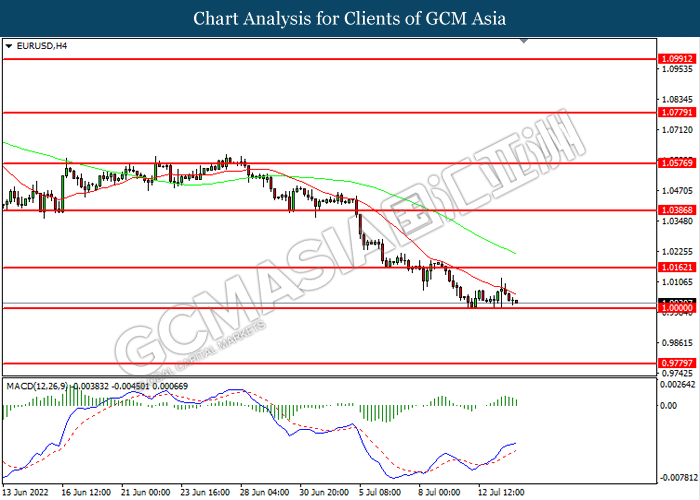

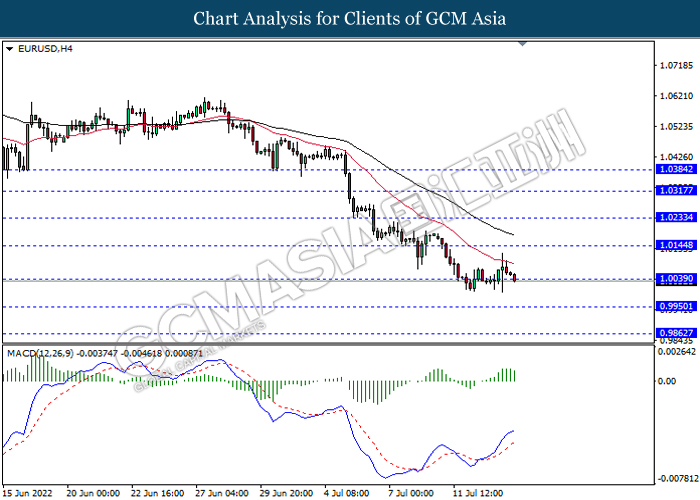

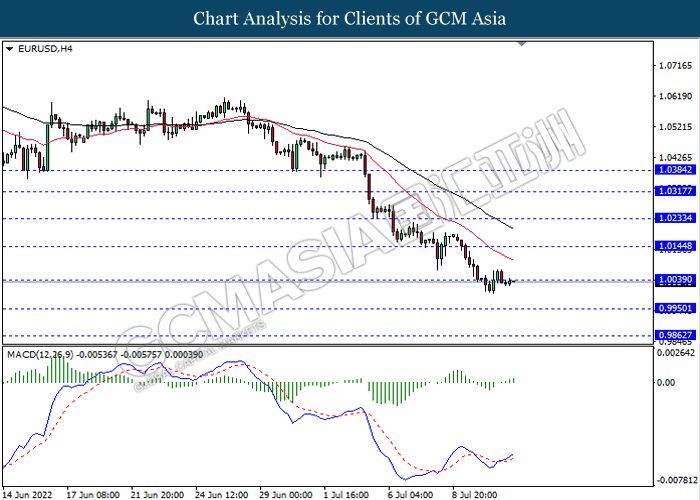

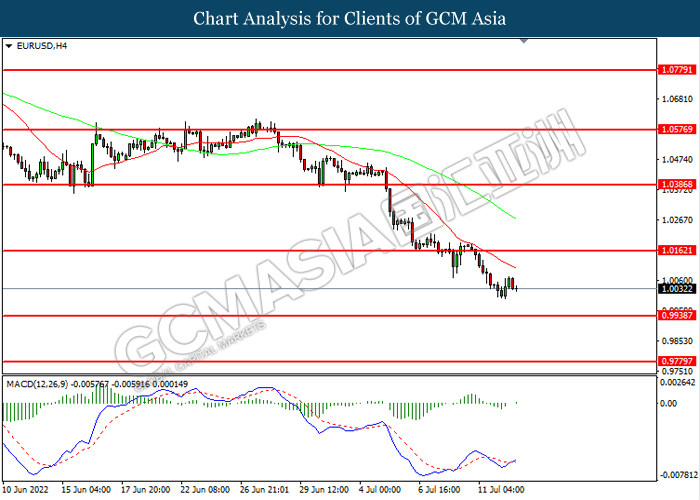

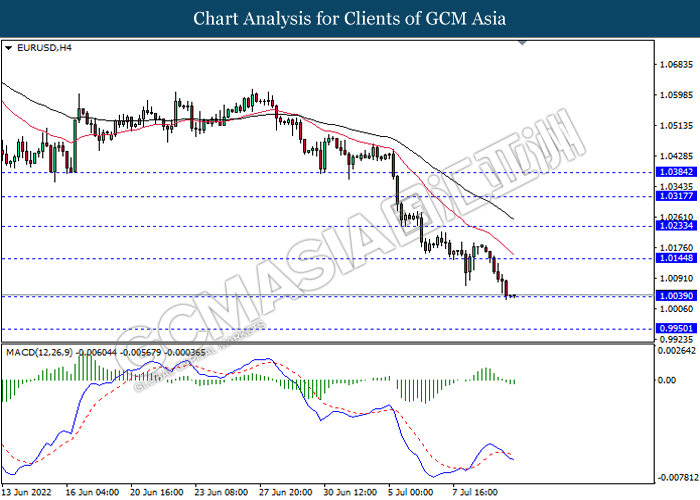

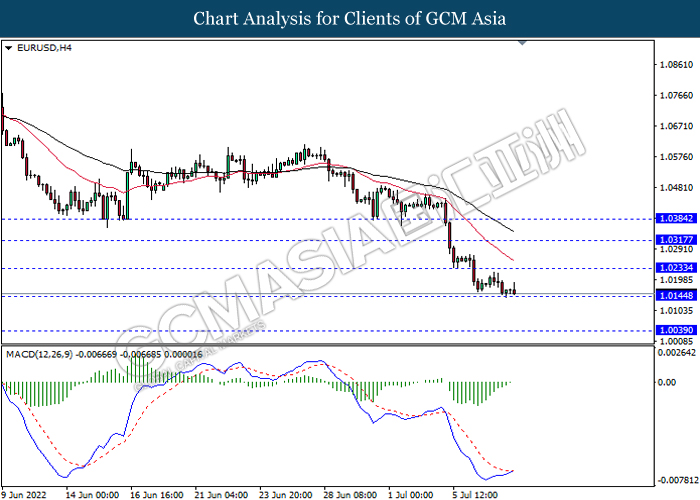

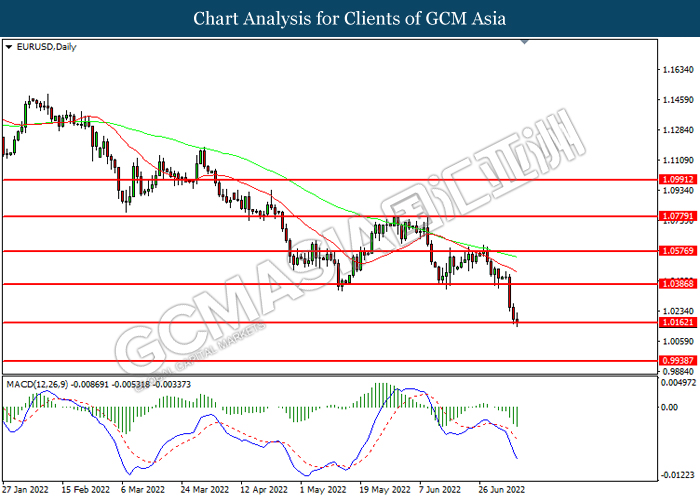

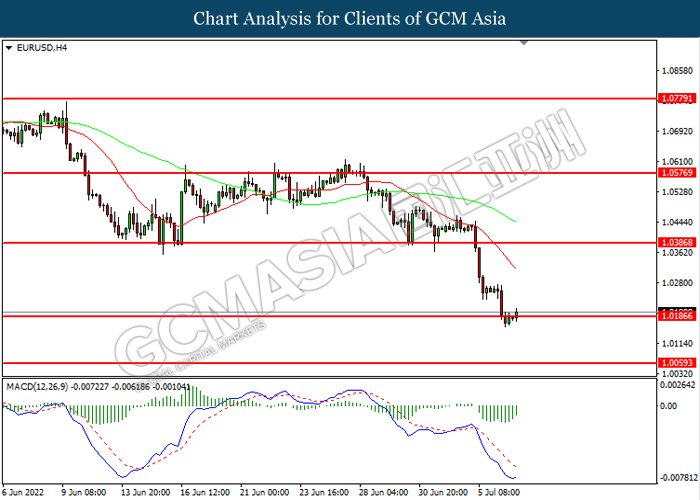

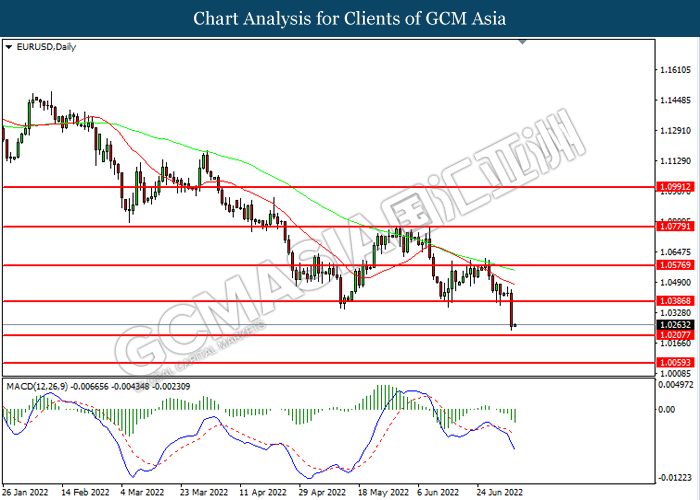

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0145, 1.0235

Support level: 1.0040, 0.9950

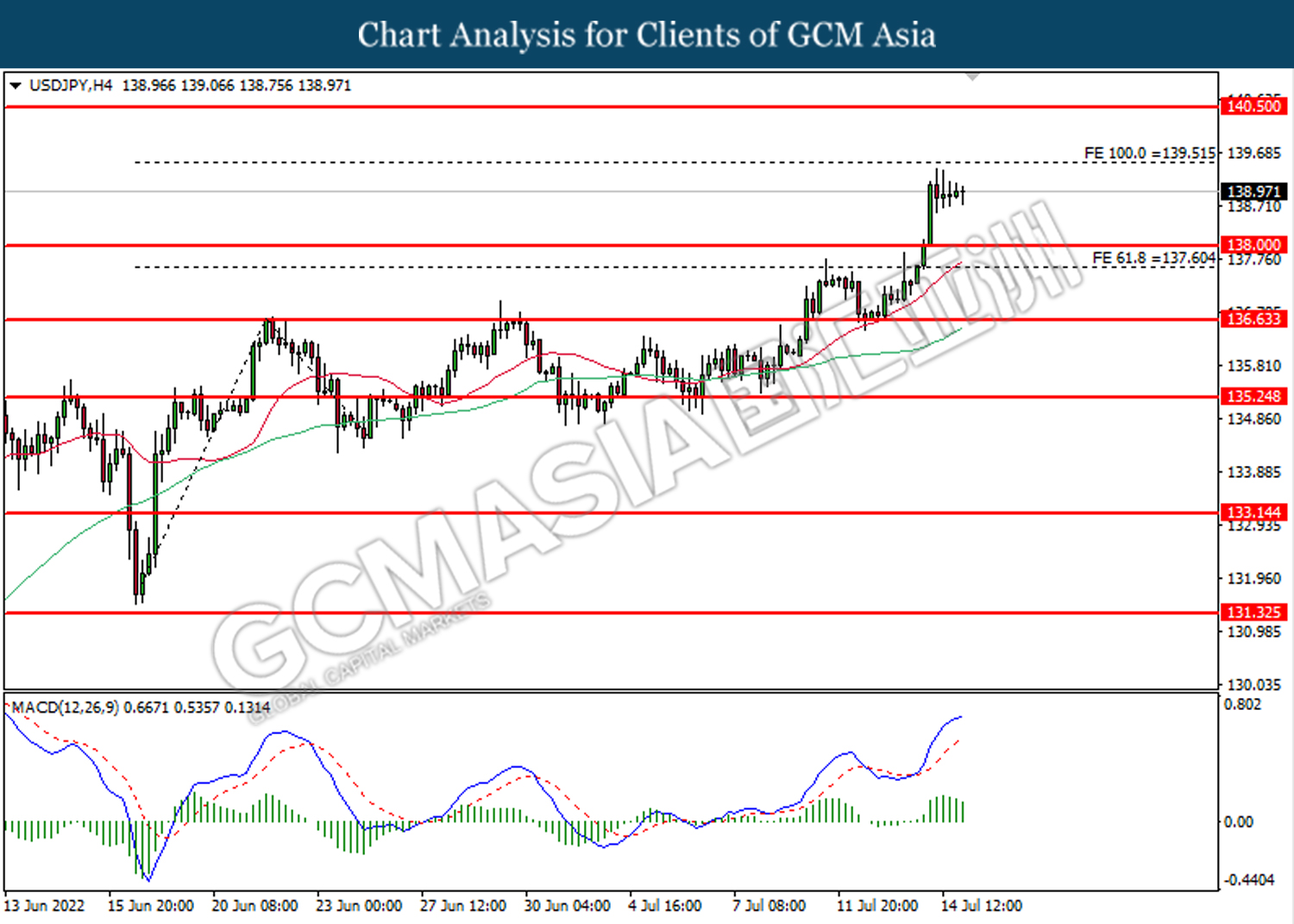

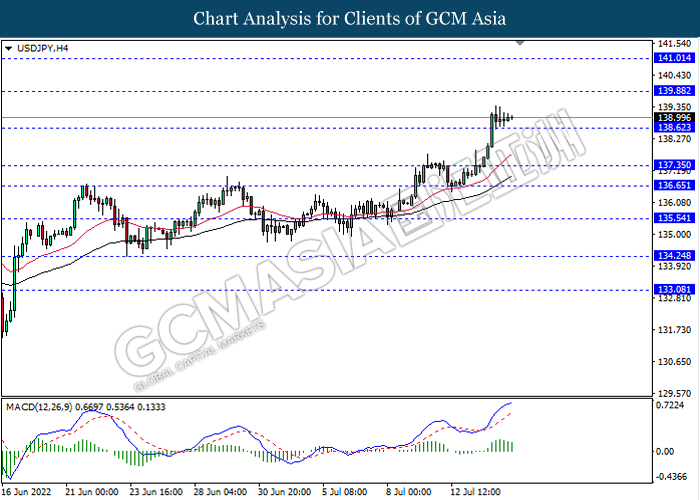

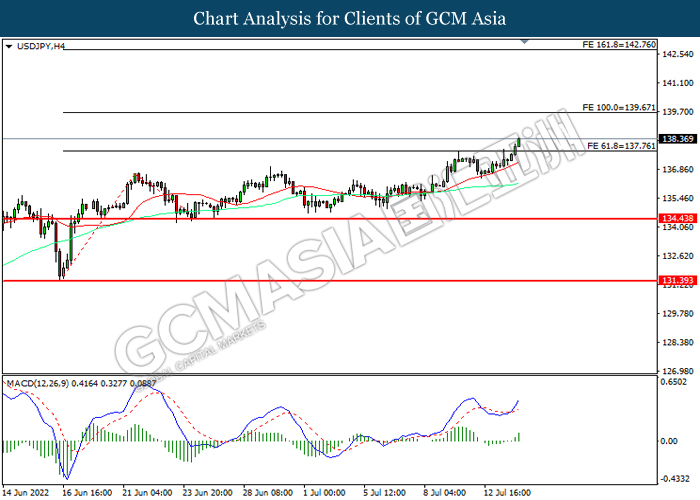

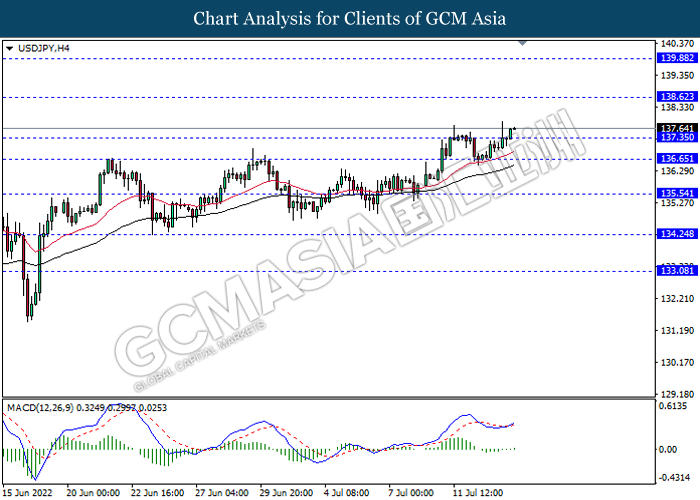

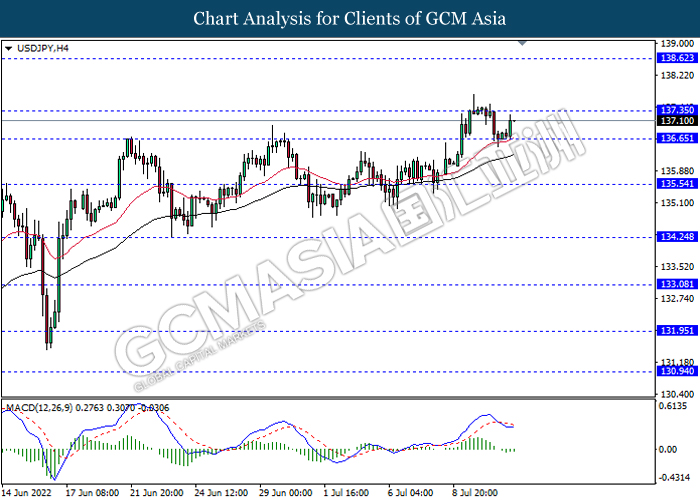

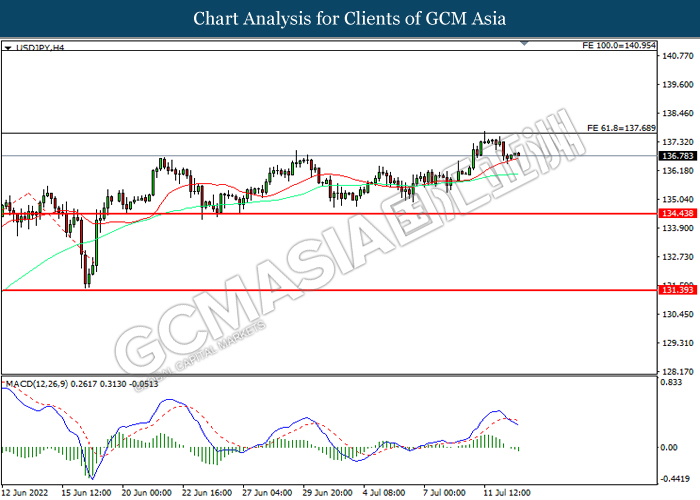

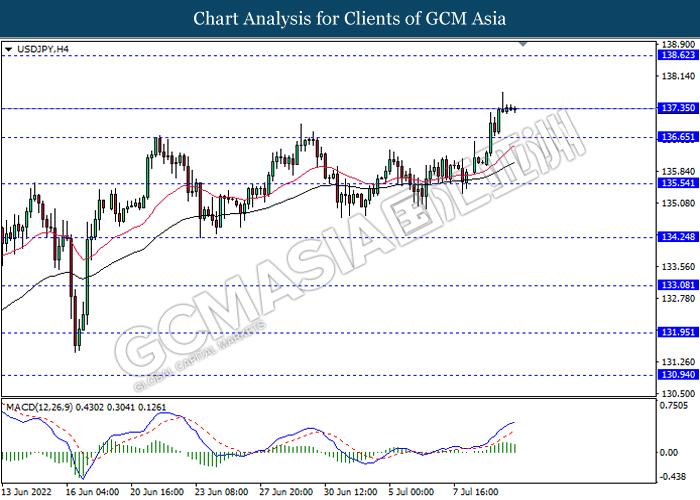

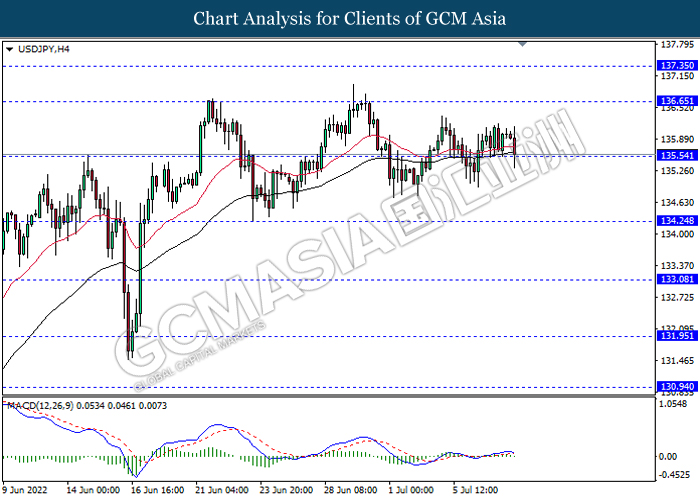

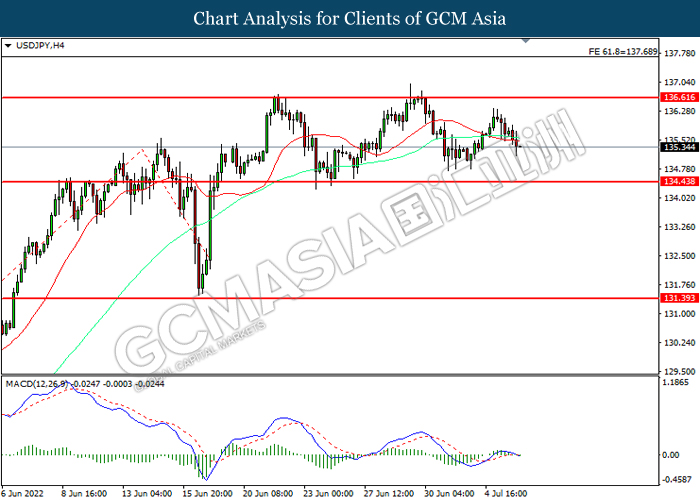

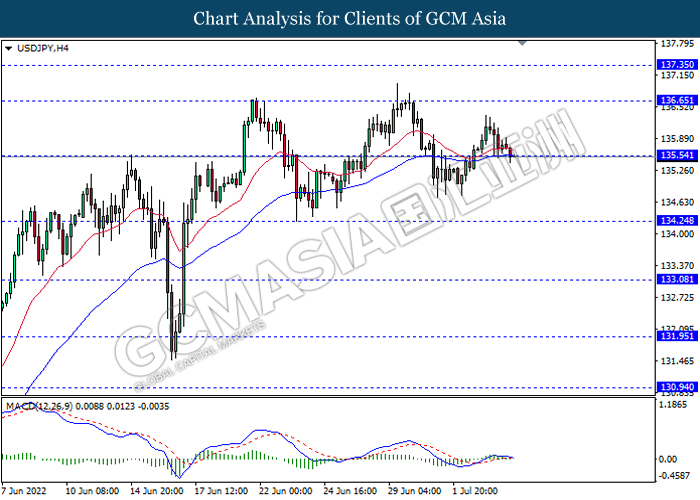

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

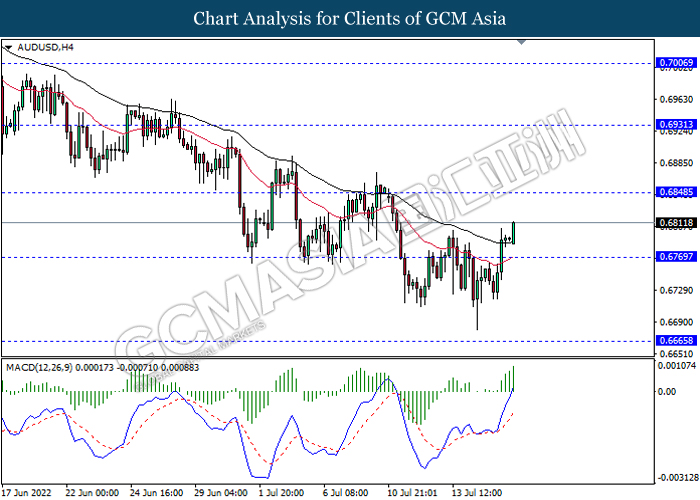

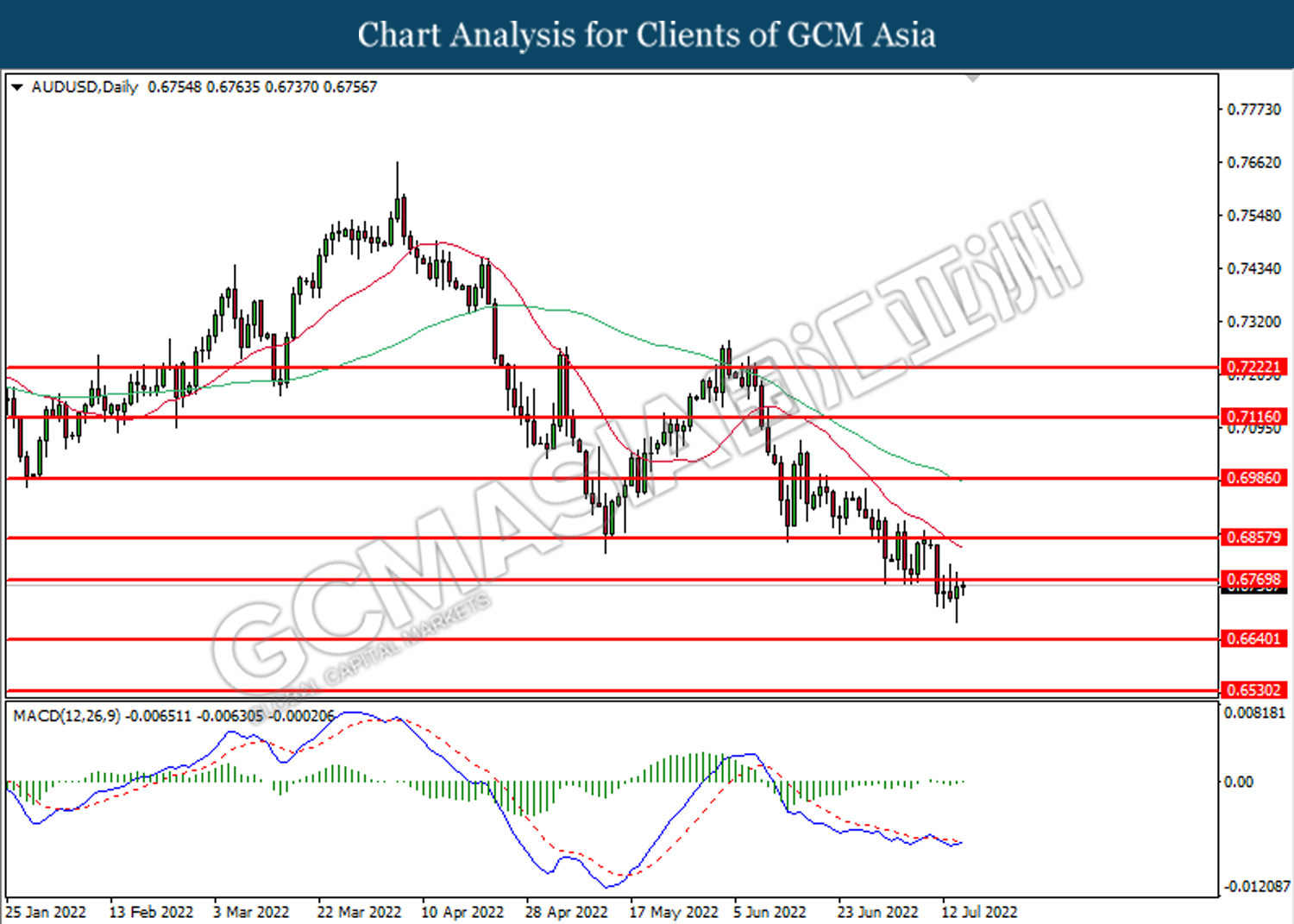

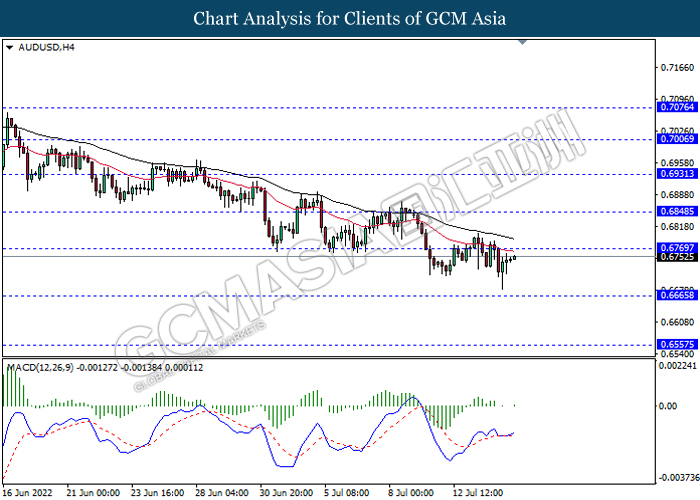

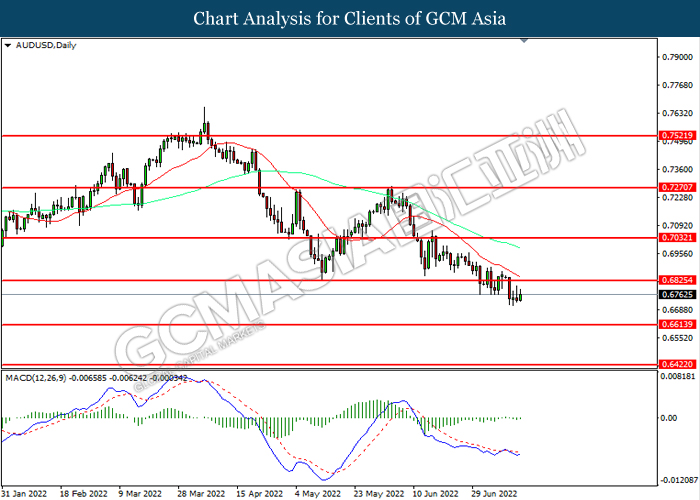

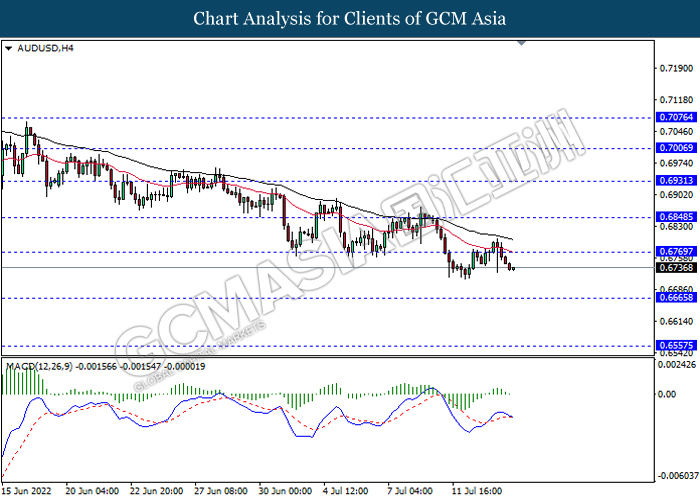

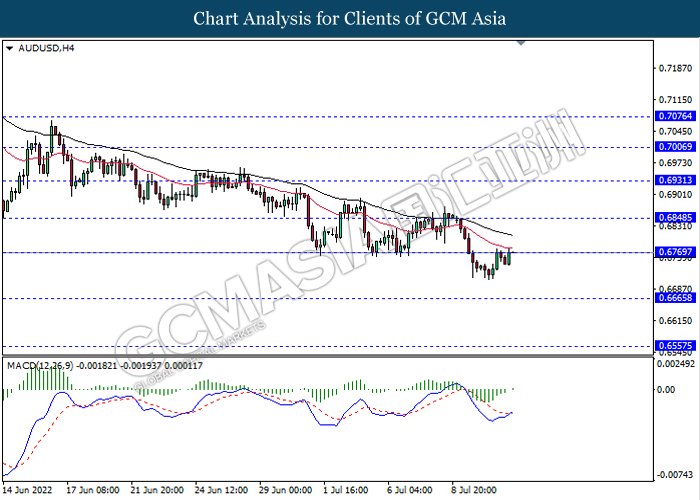

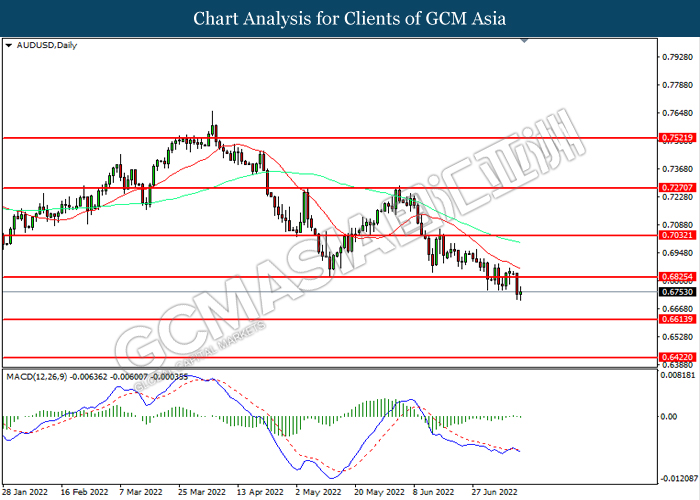

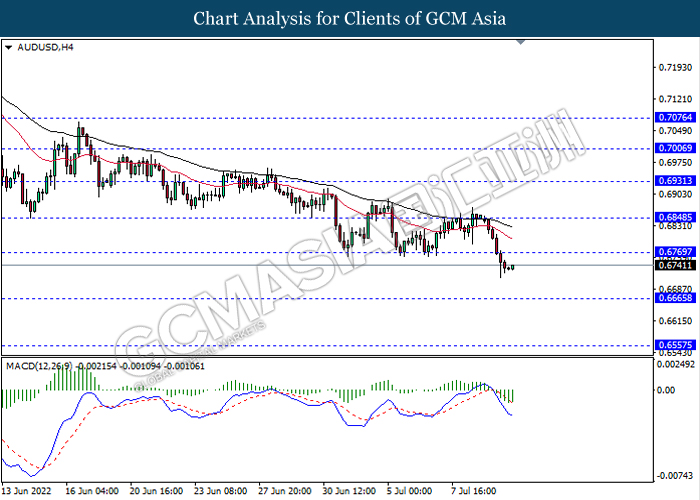

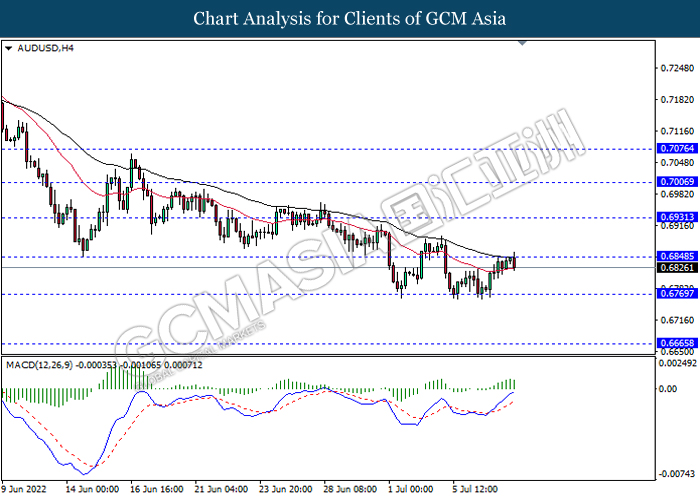

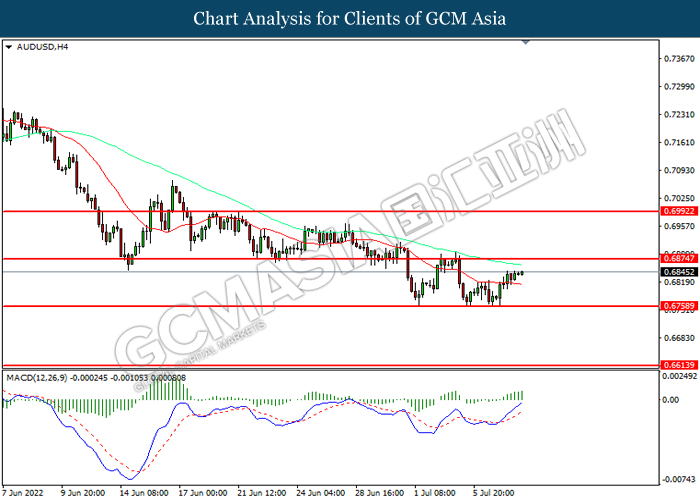

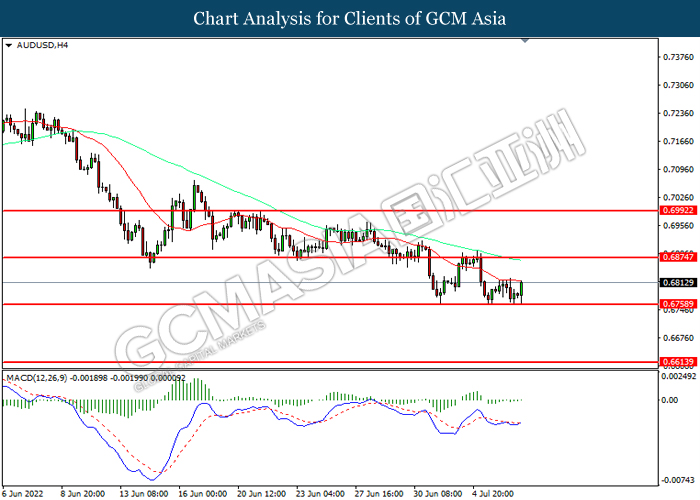

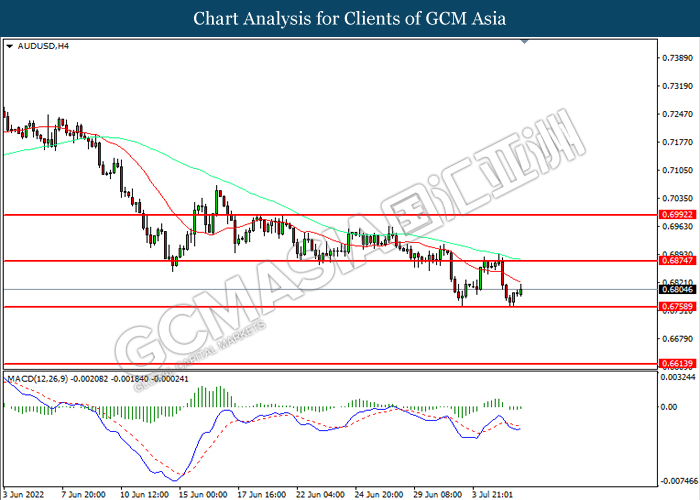

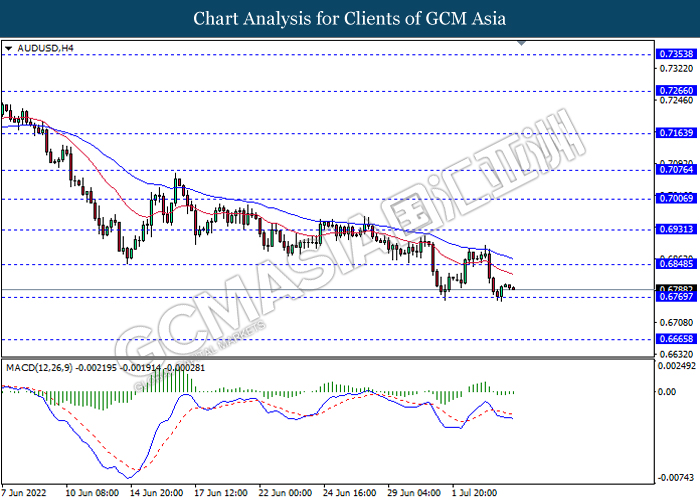

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

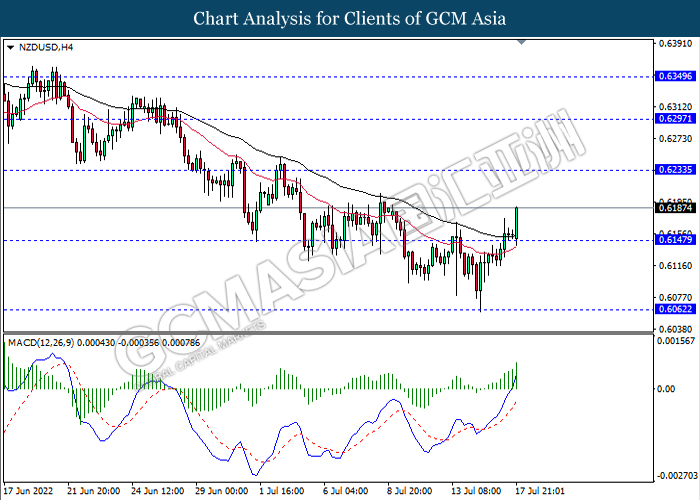

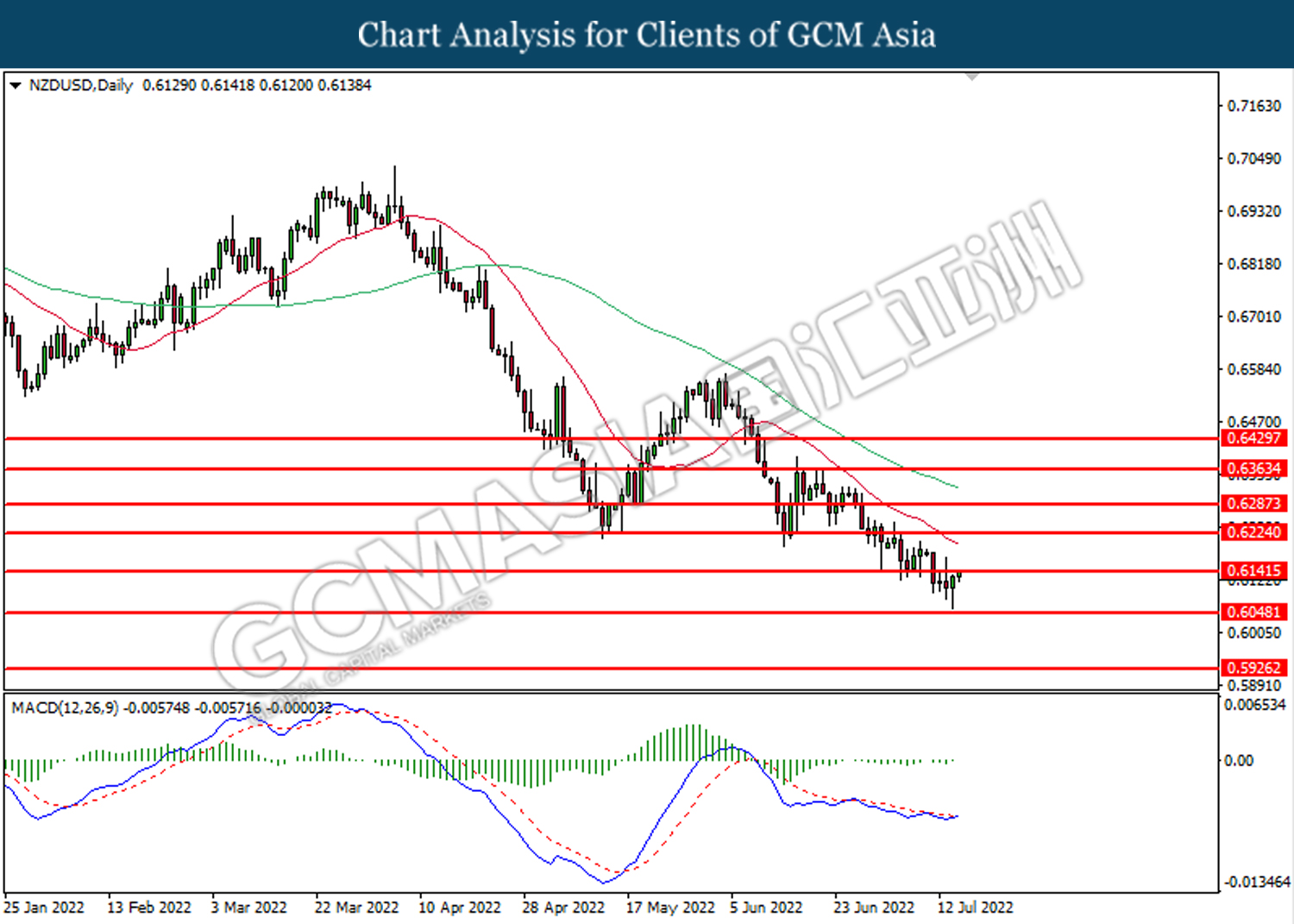

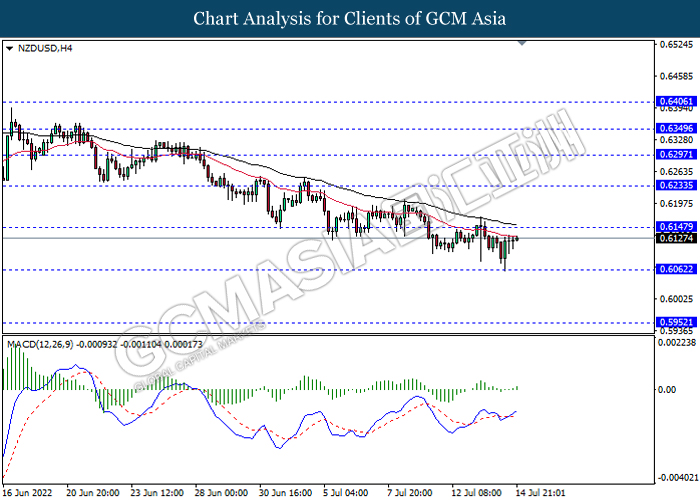

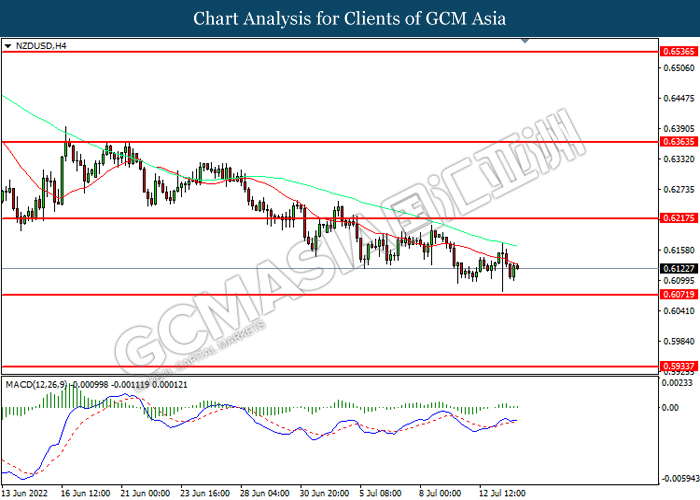

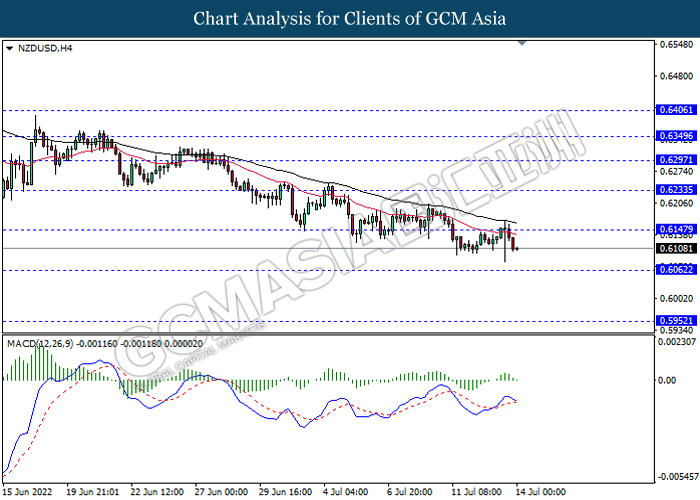

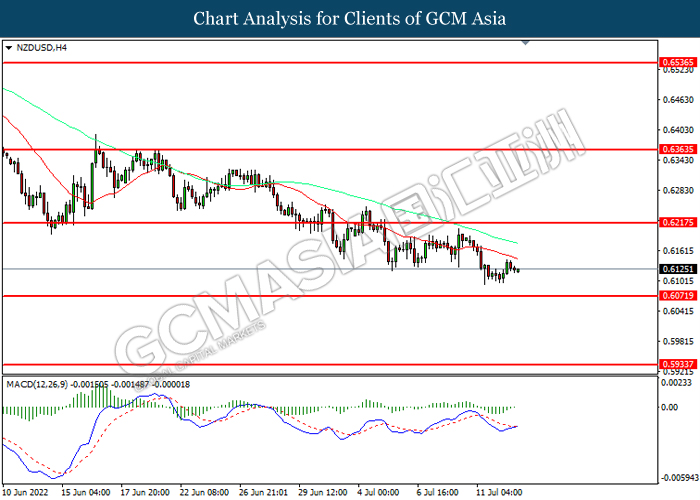

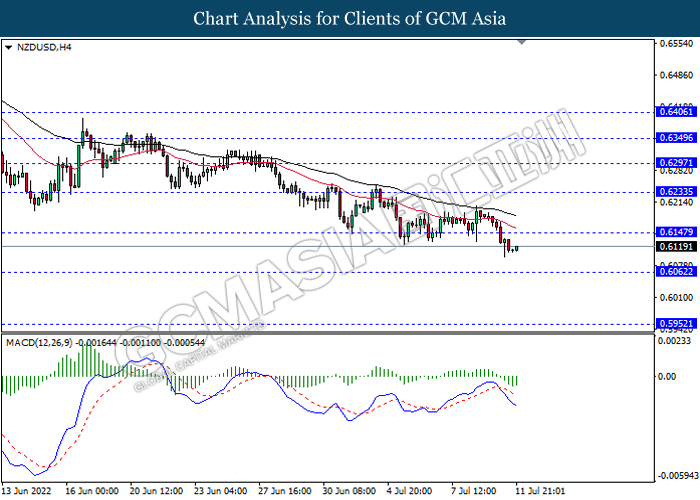

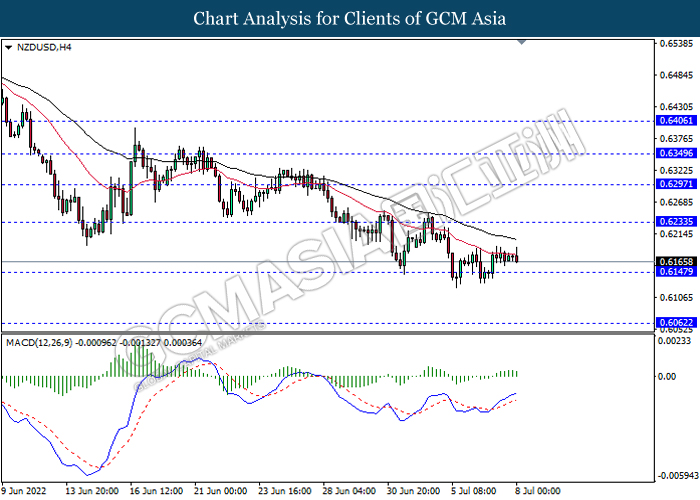

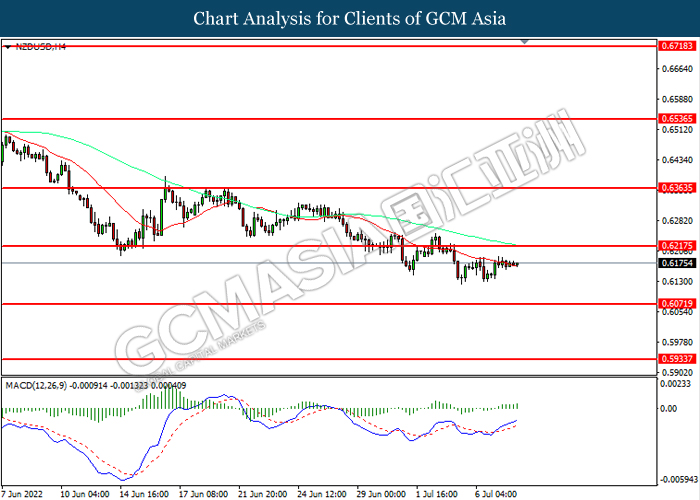

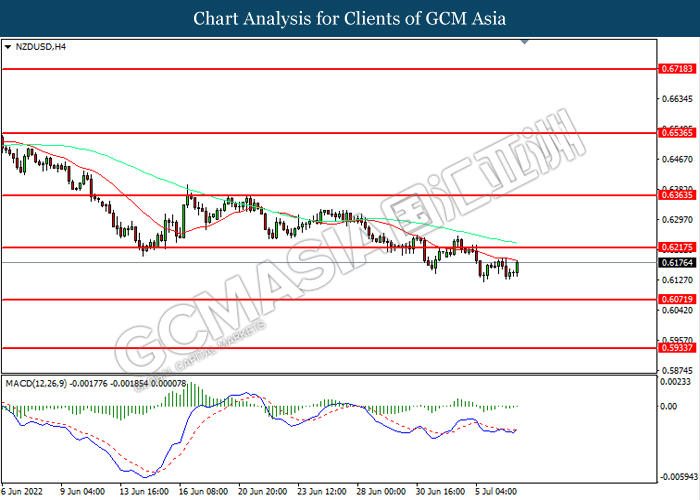

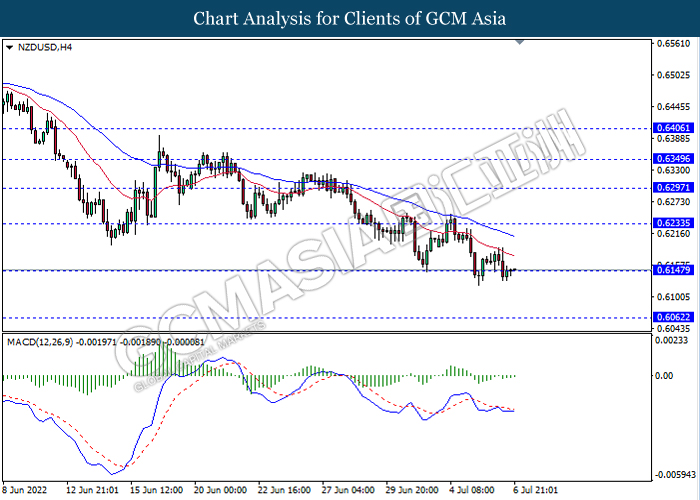

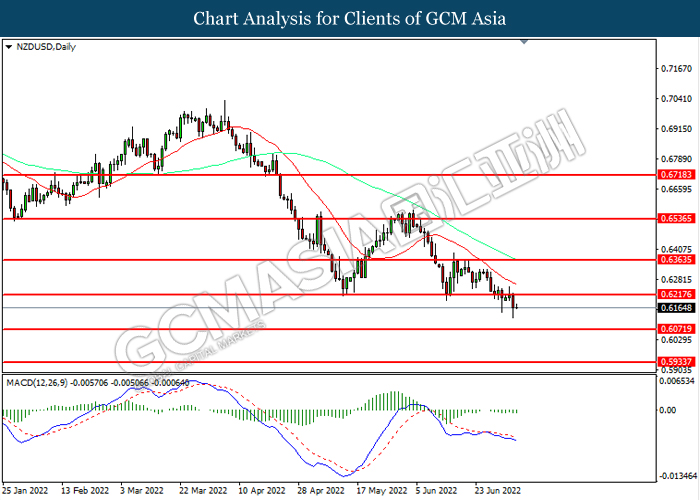

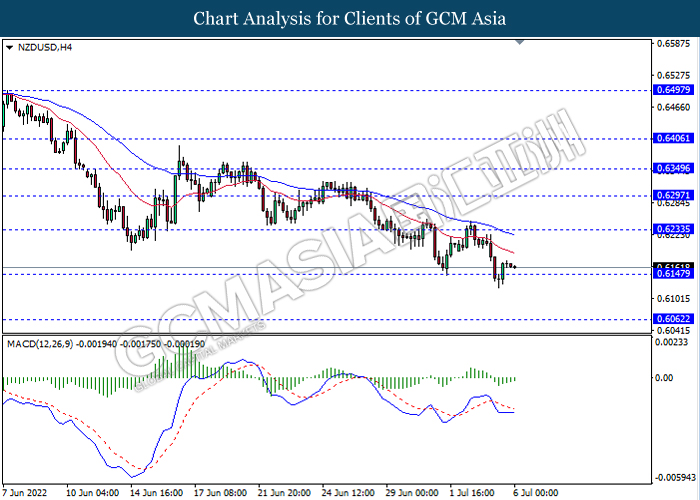

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

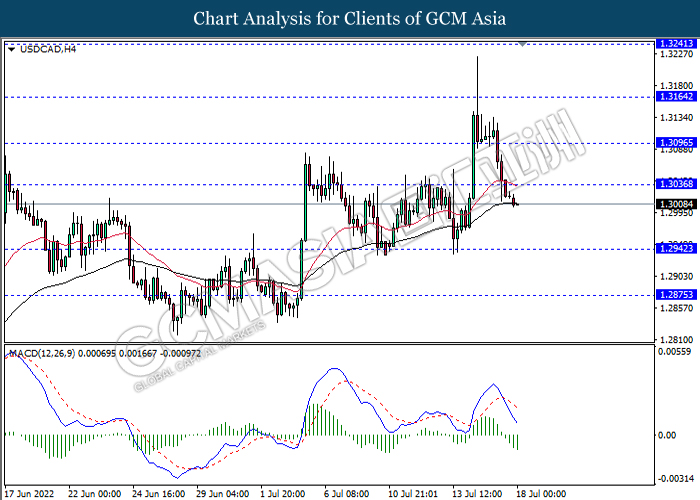

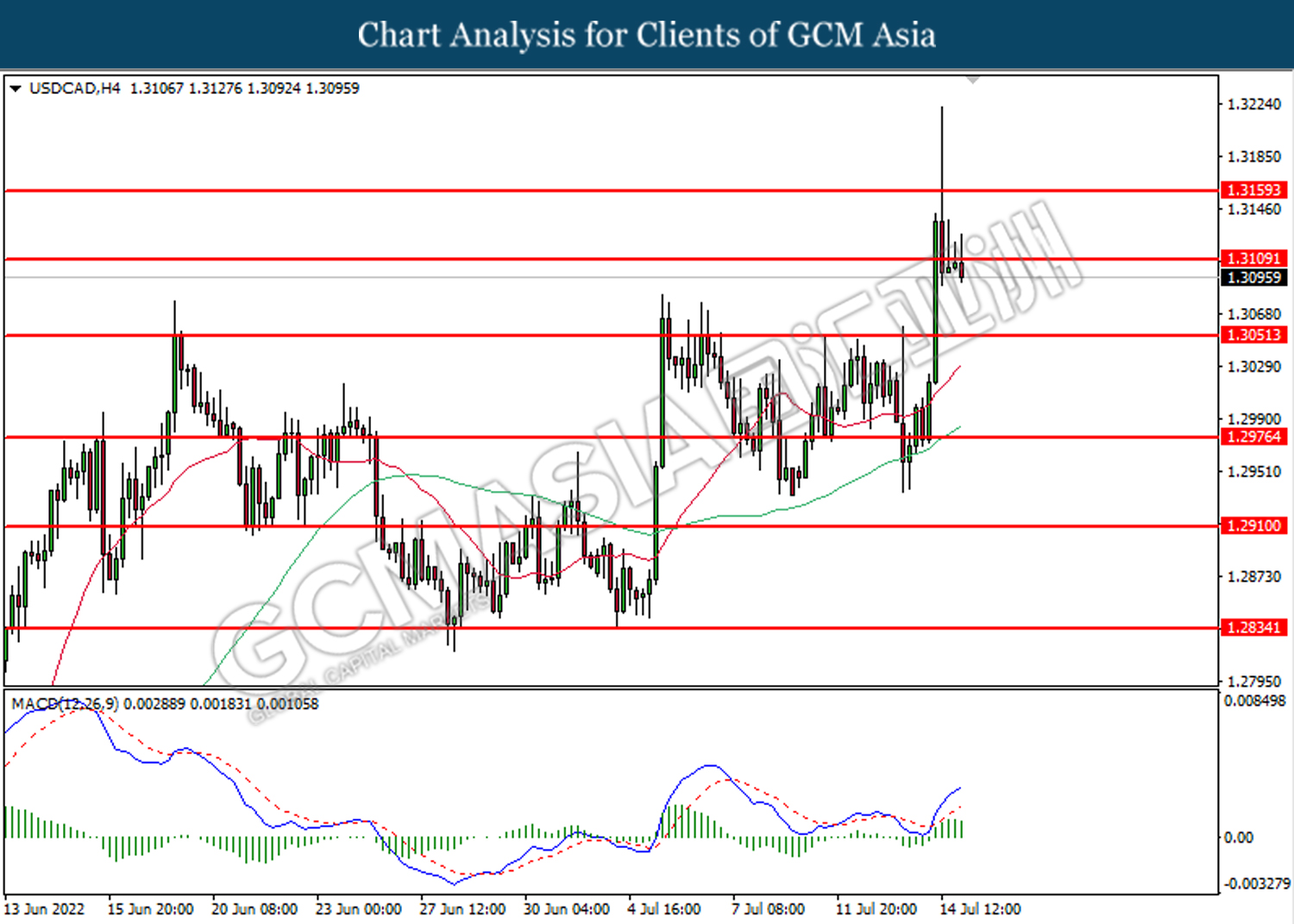

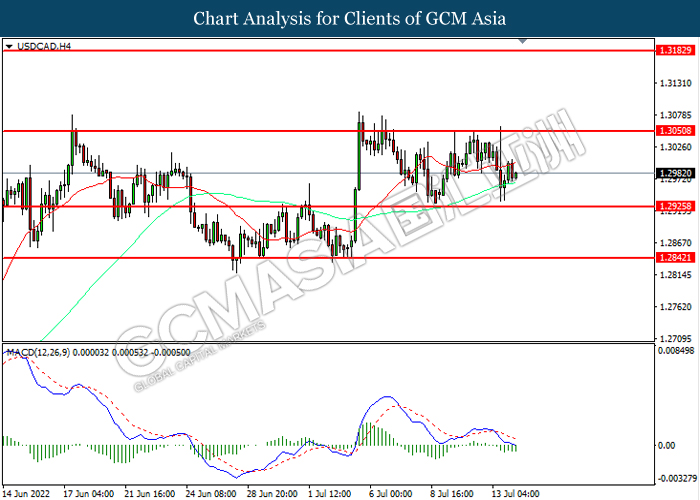

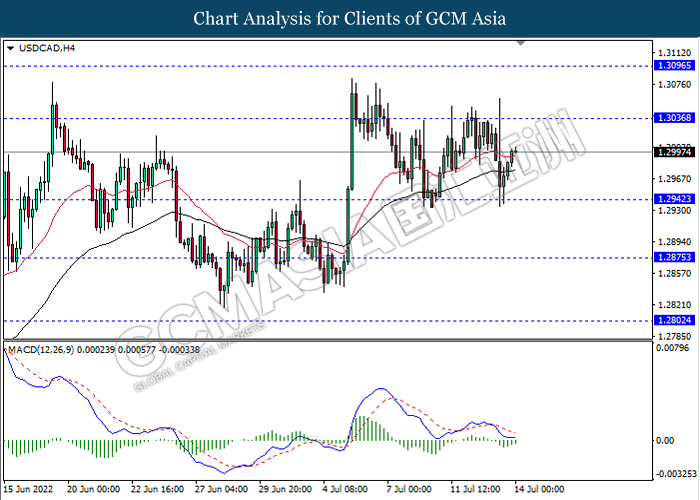

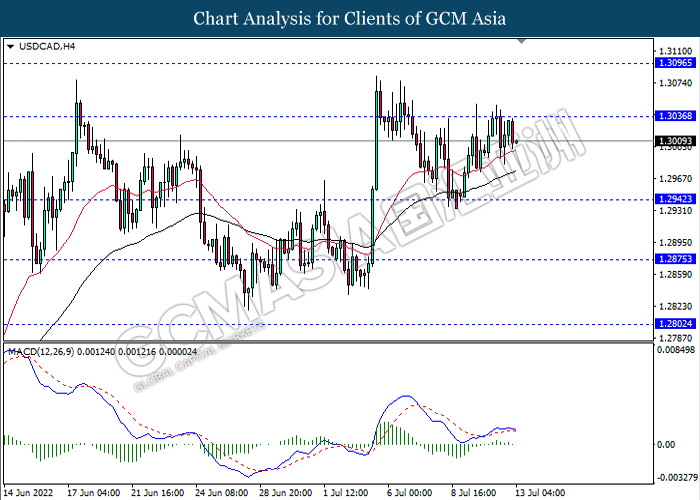

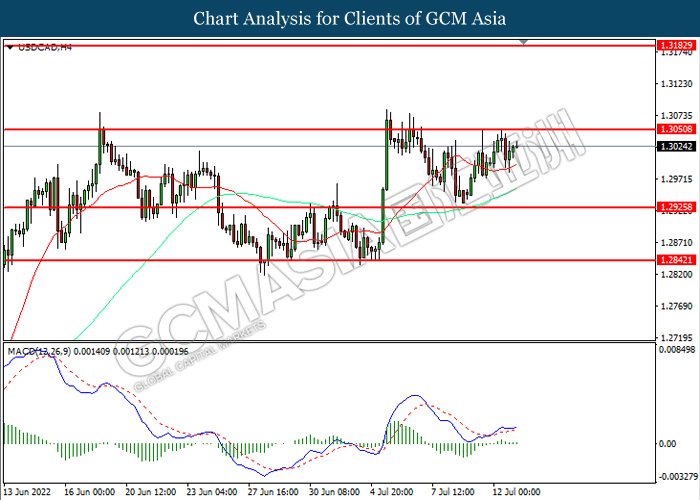

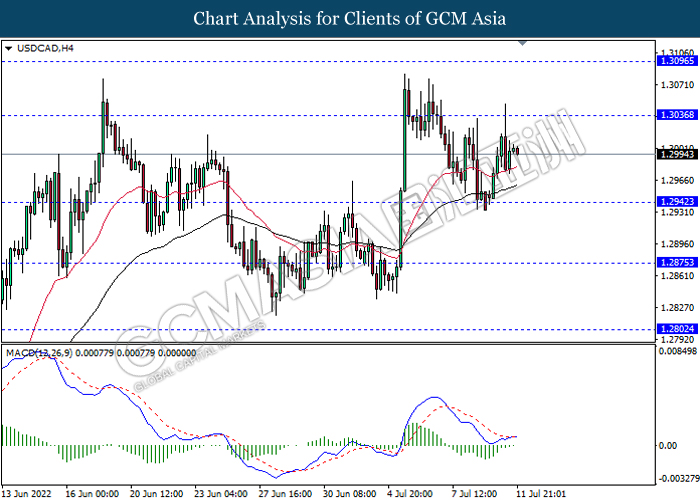

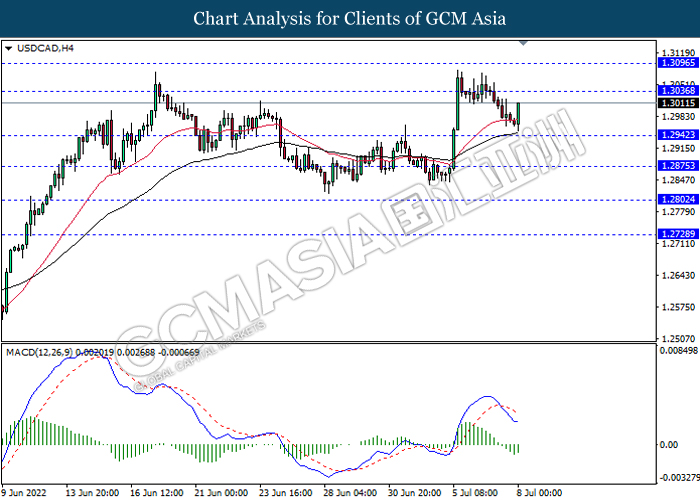

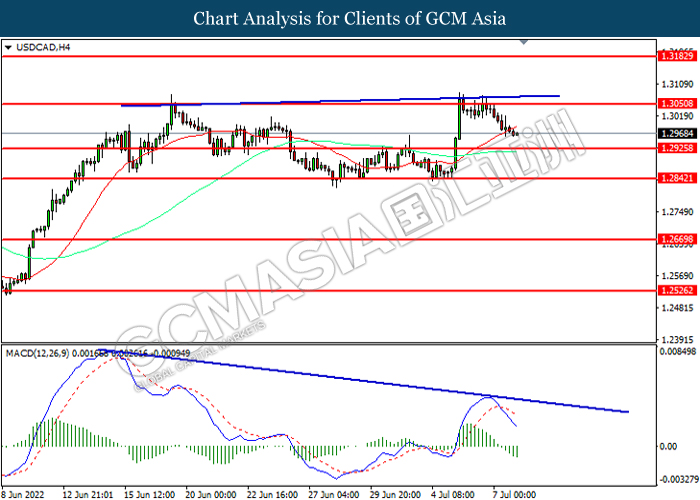

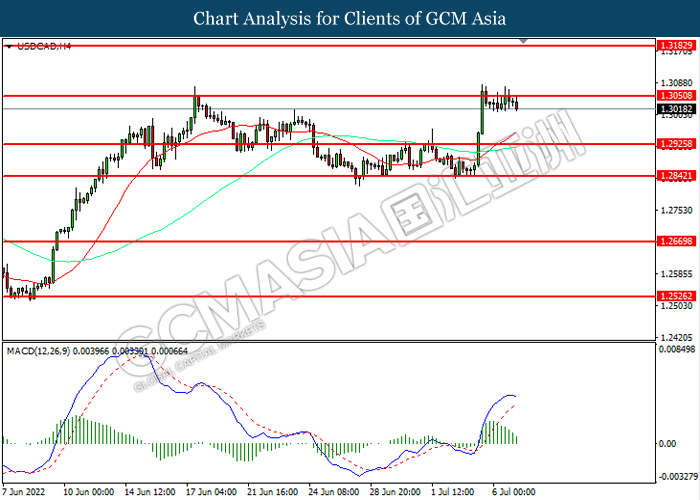

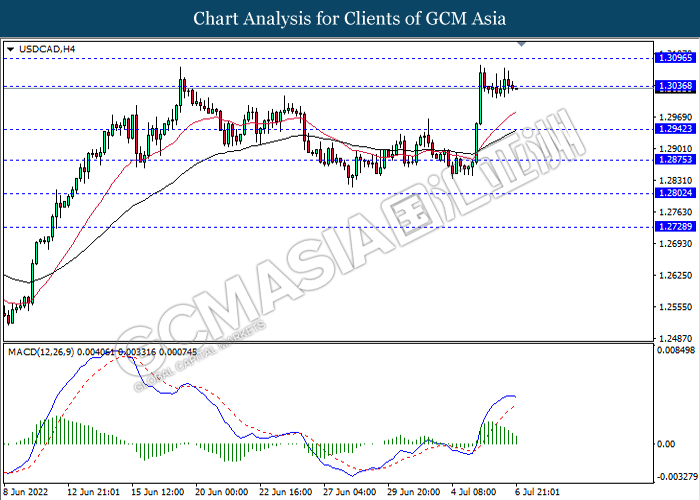

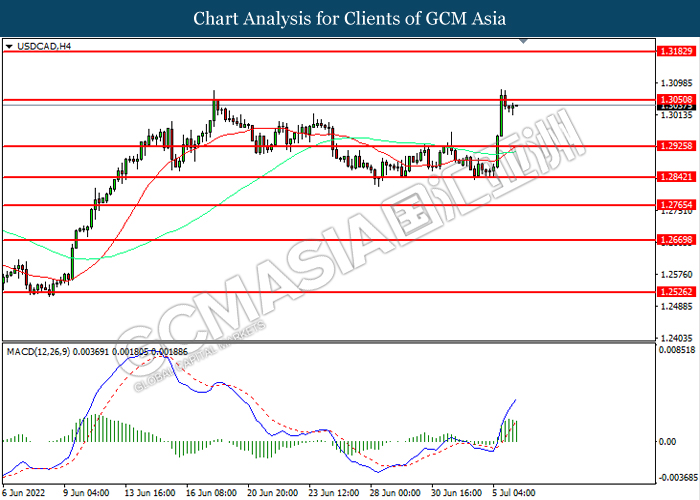

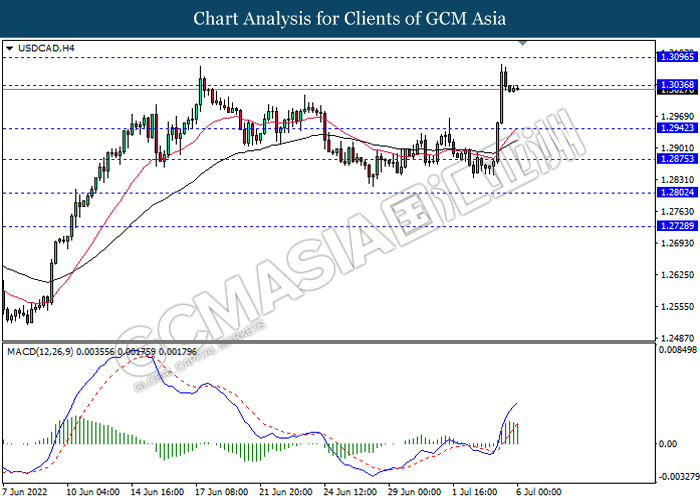

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

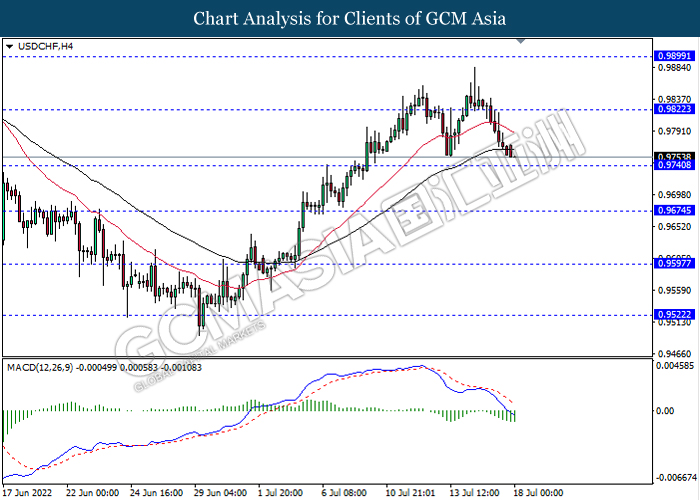

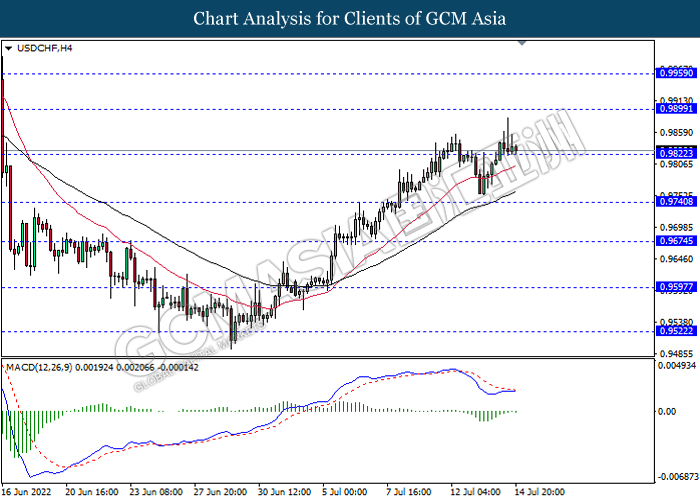

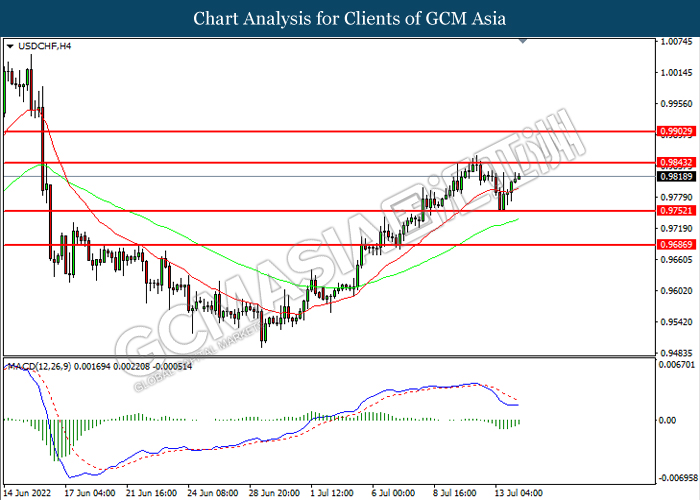

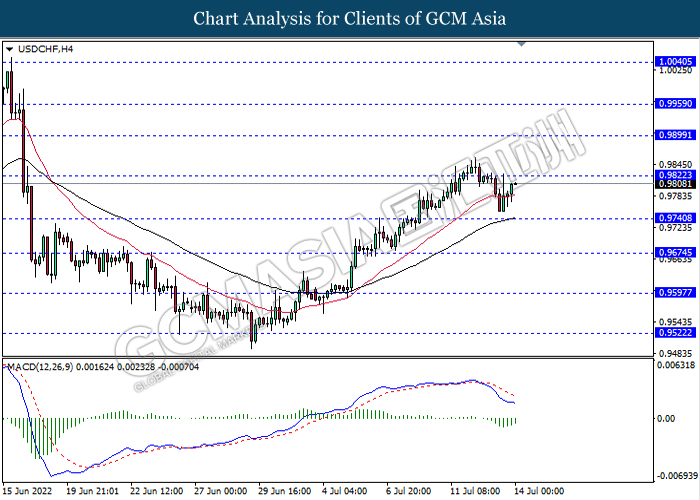

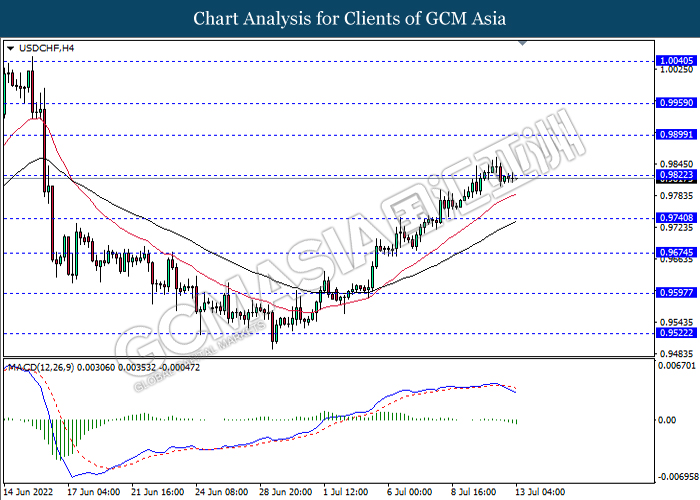

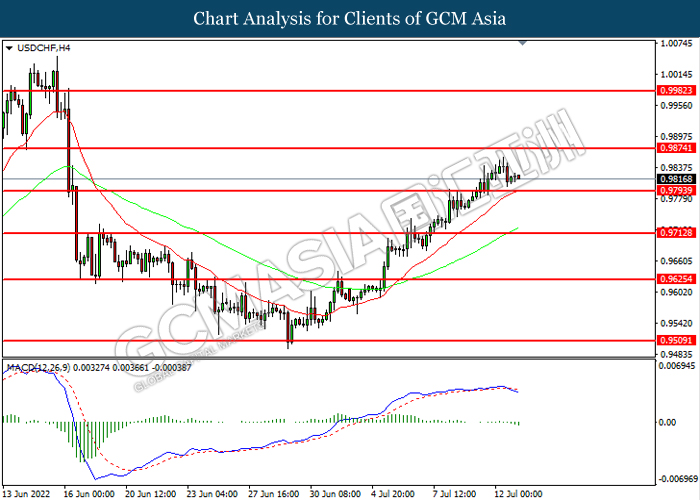

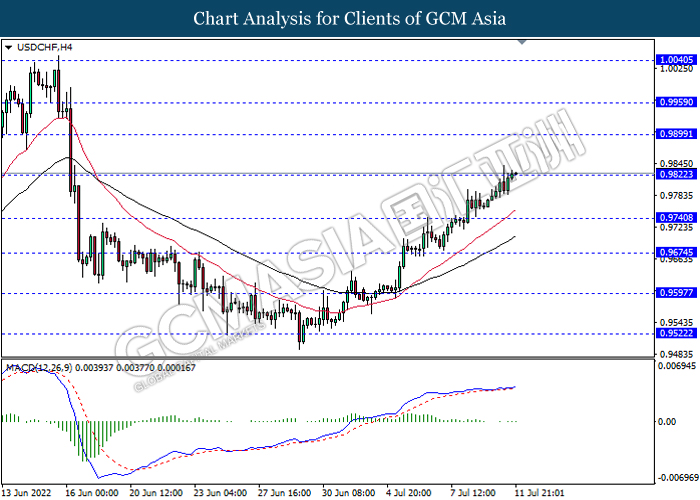

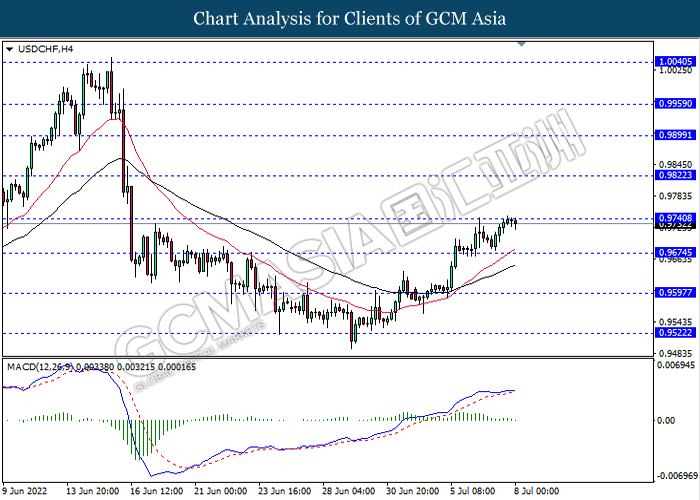

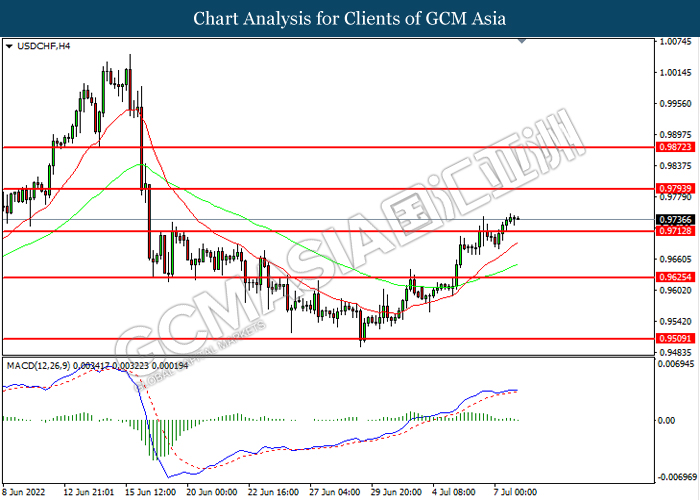

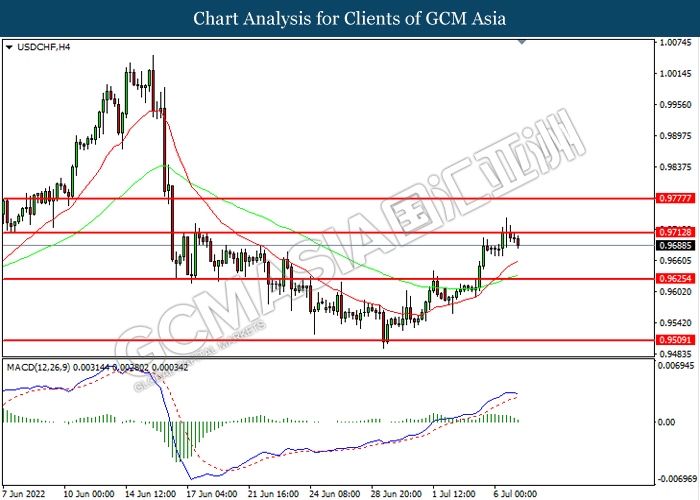

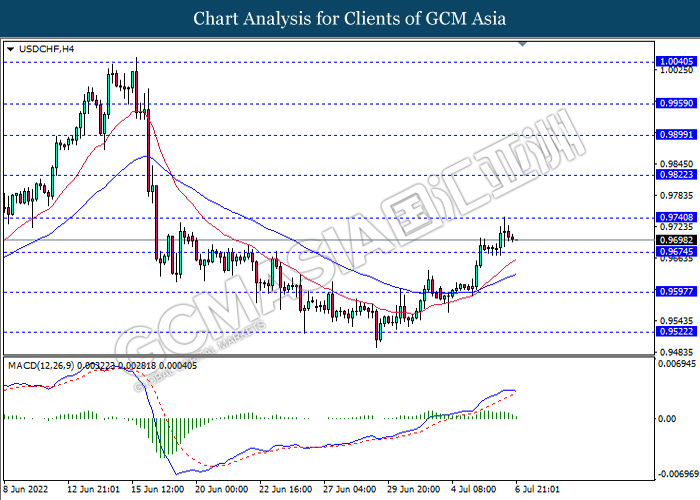

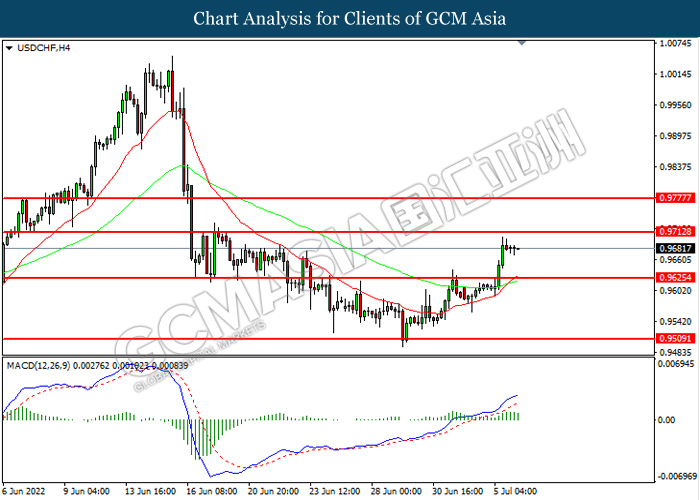

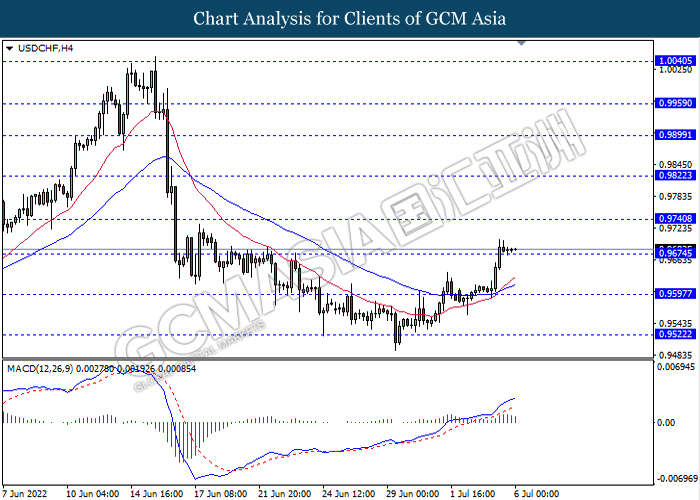

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

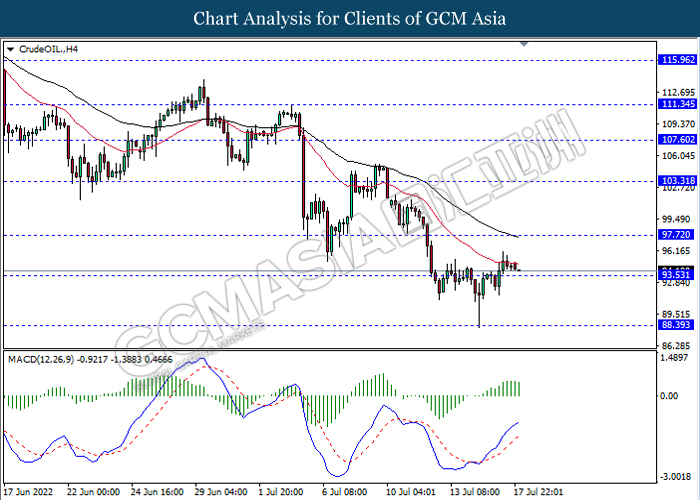

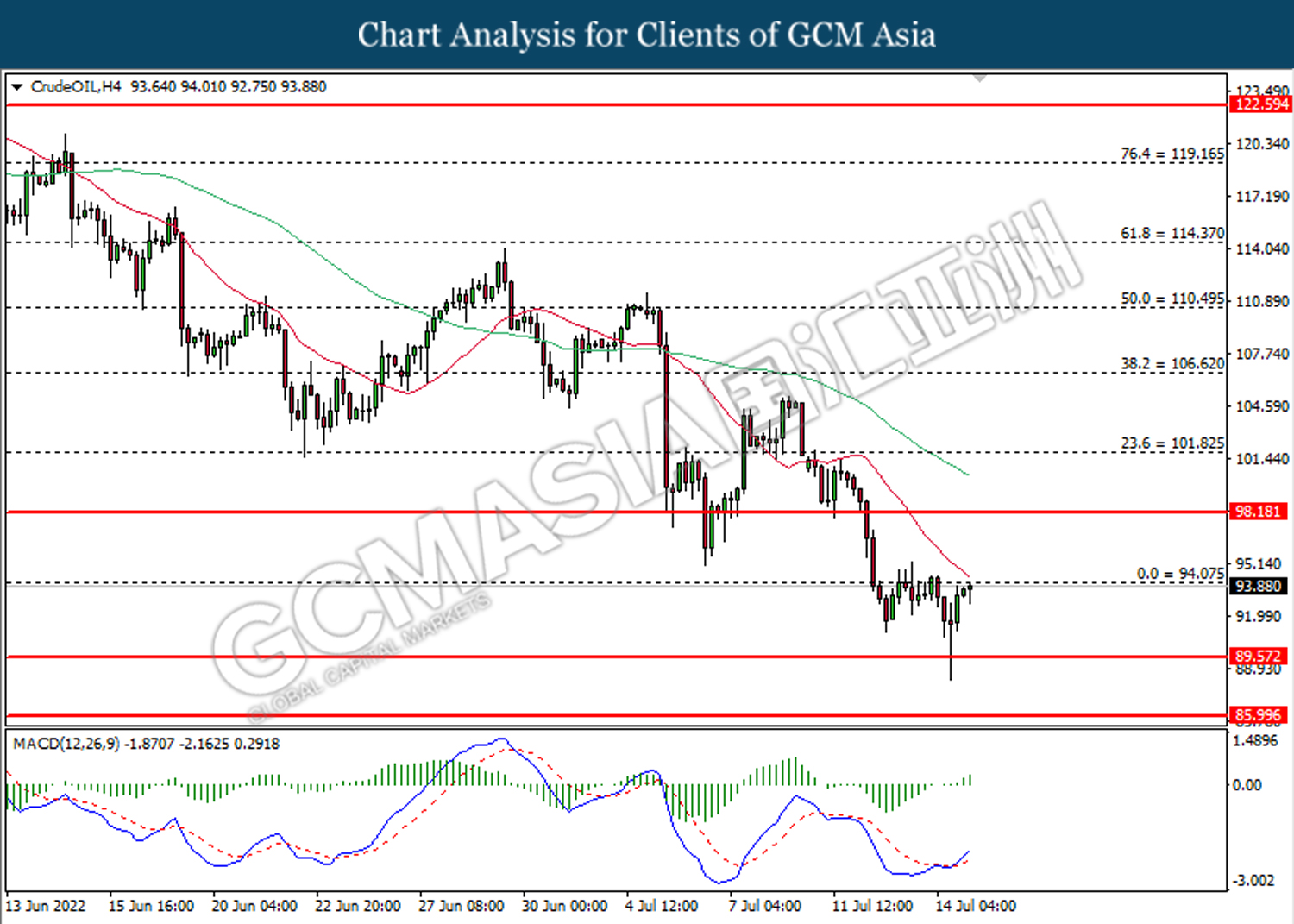

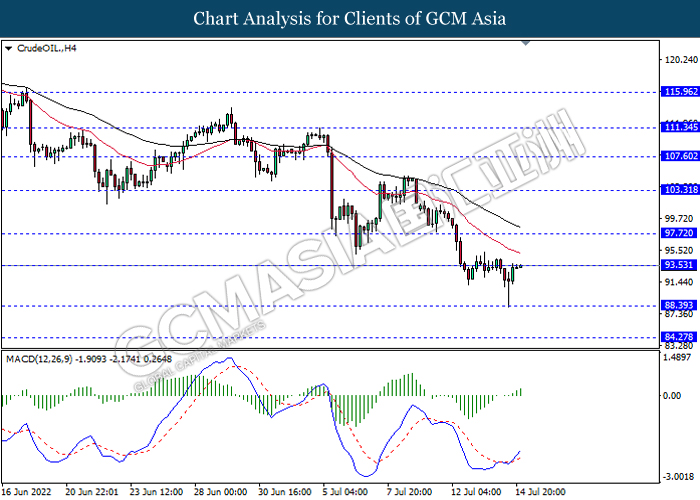

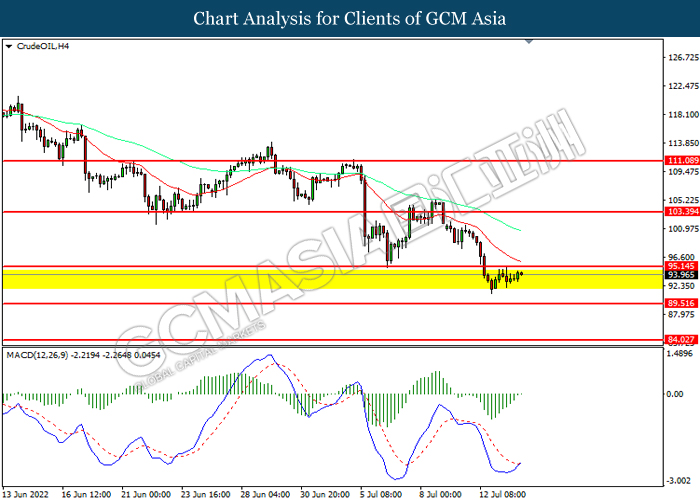

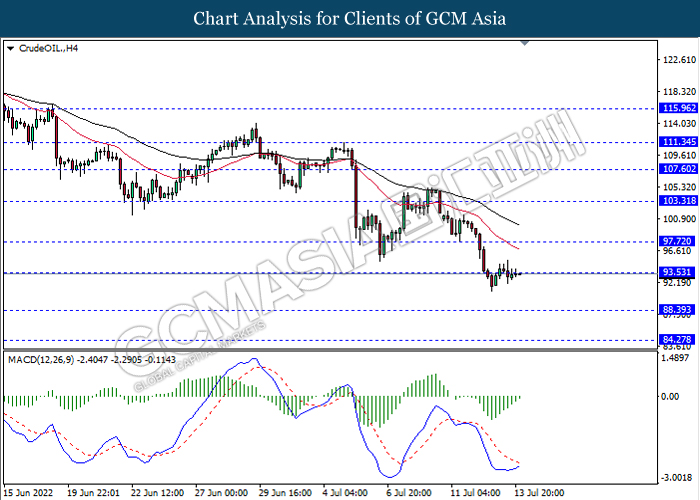

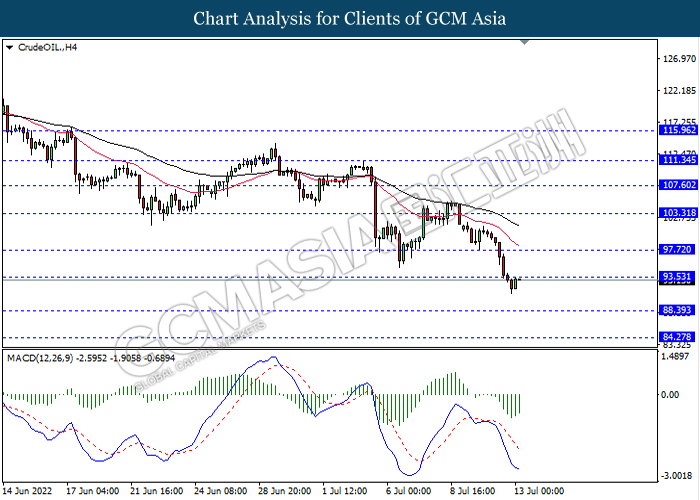

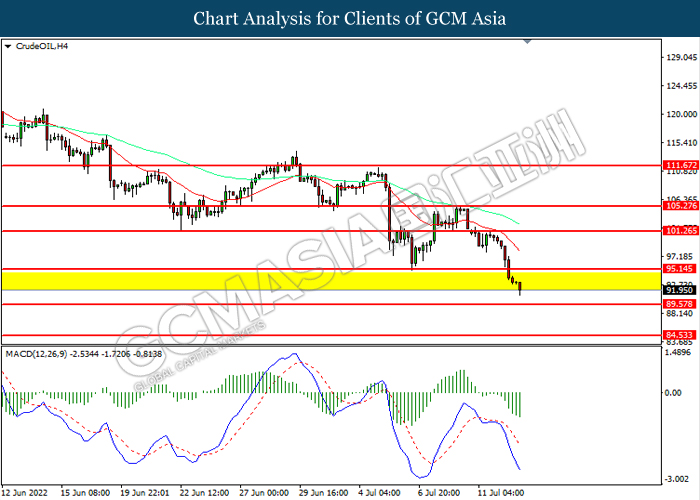

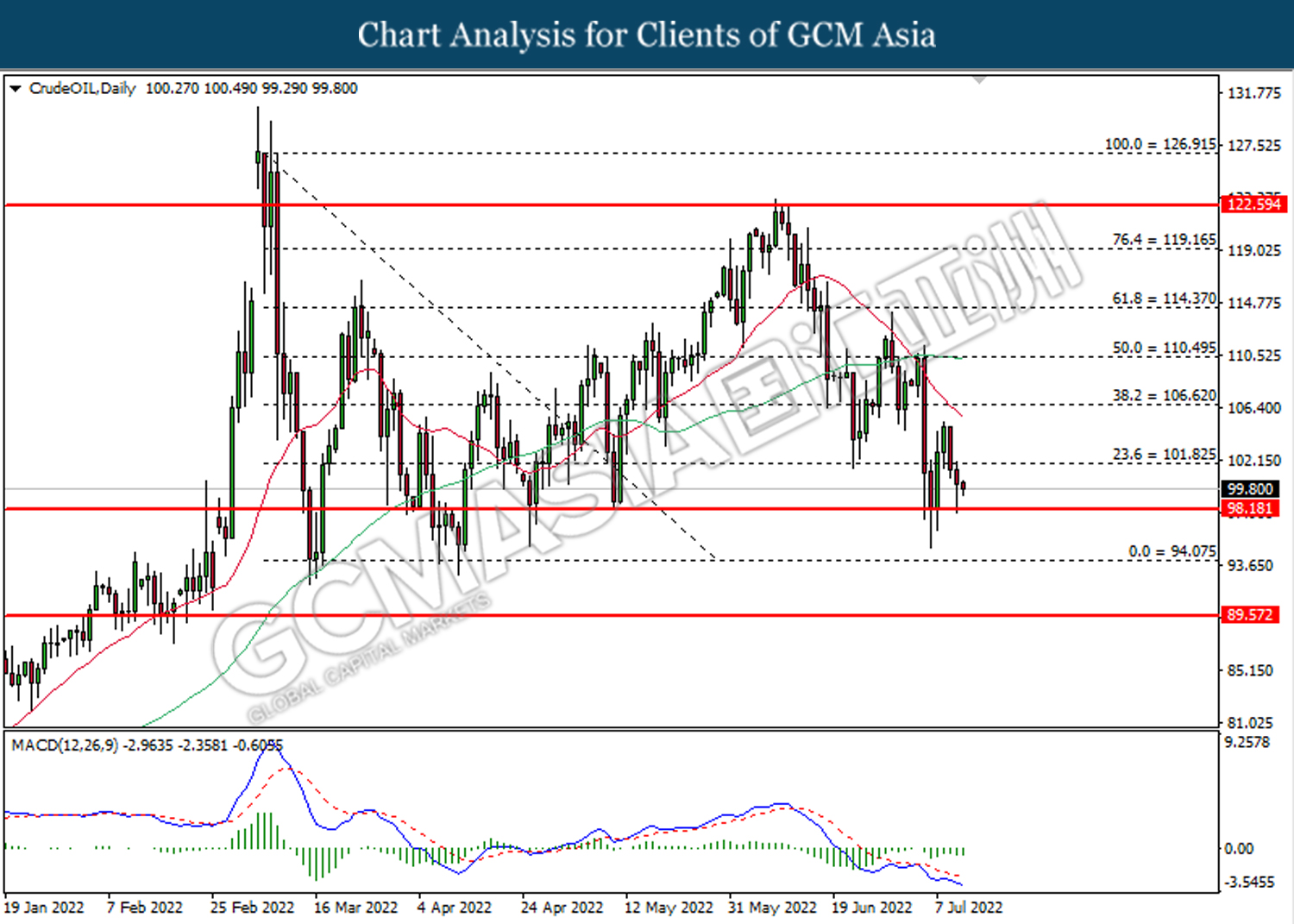

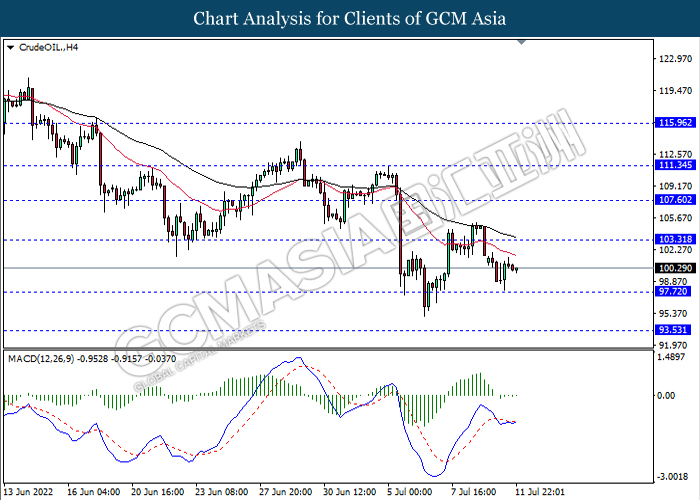

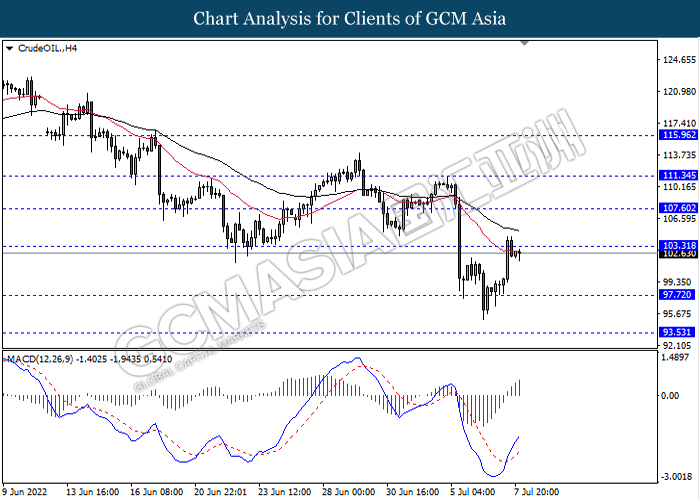

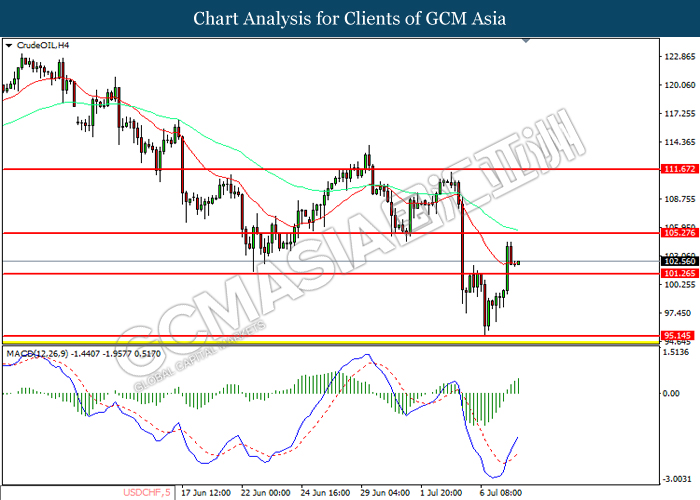

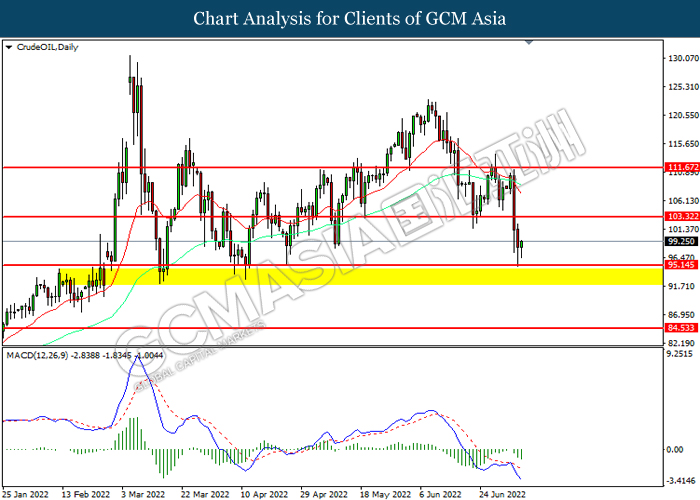

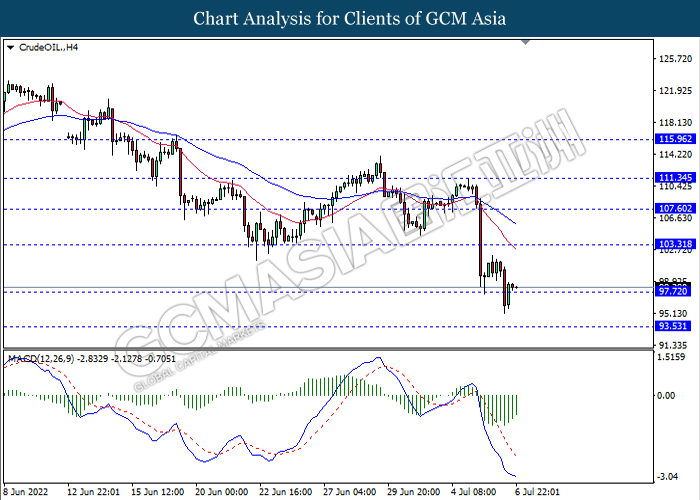

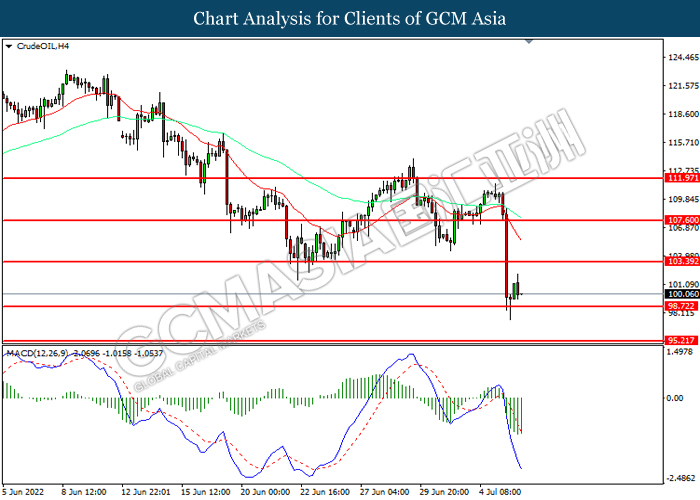

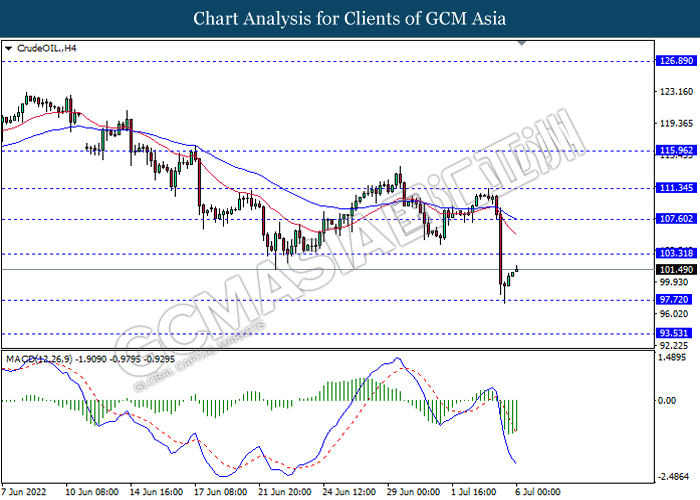

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

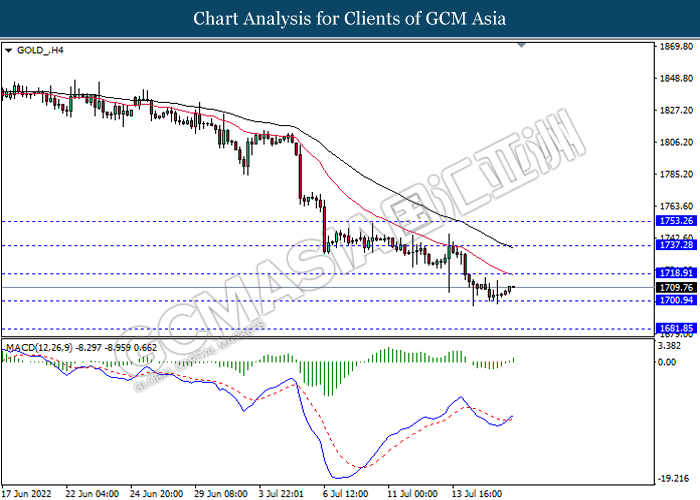

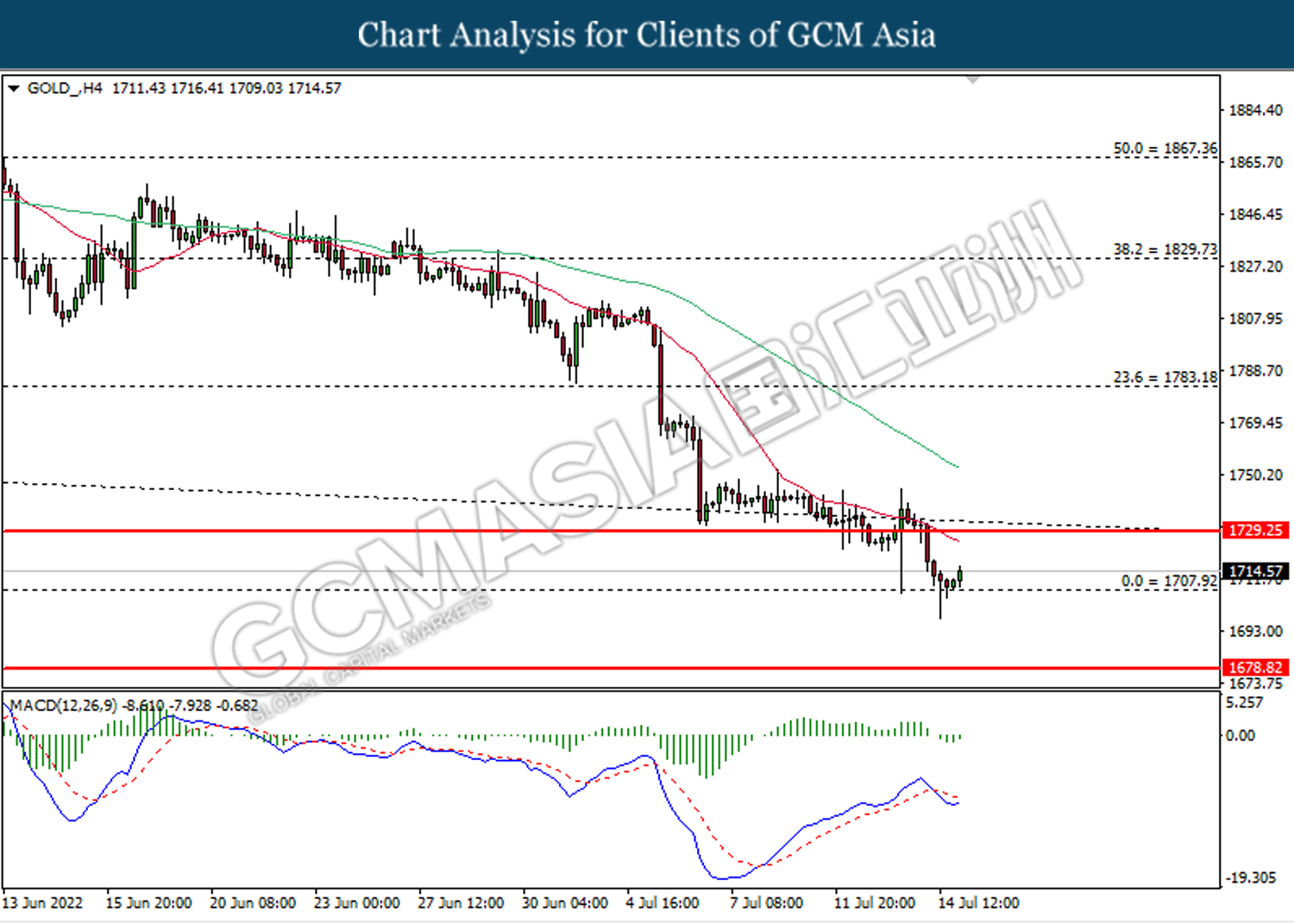

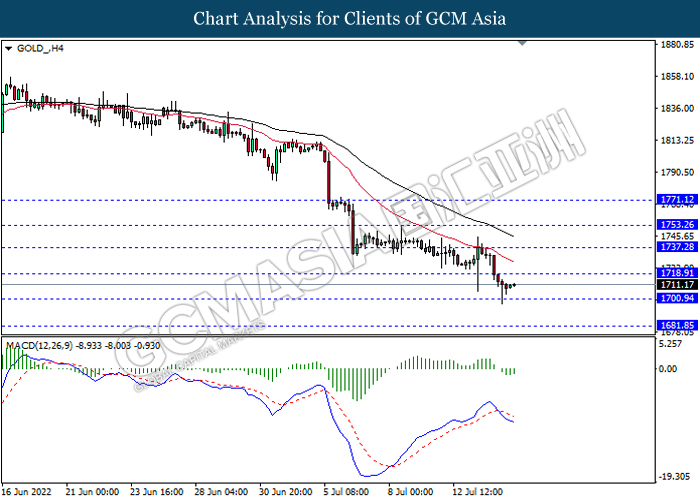

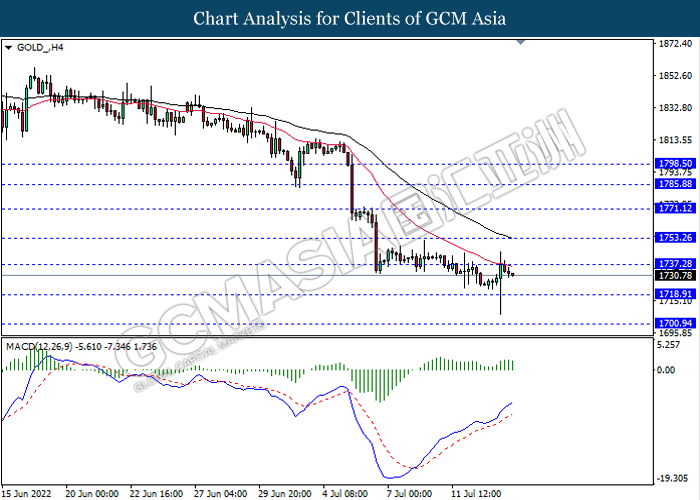

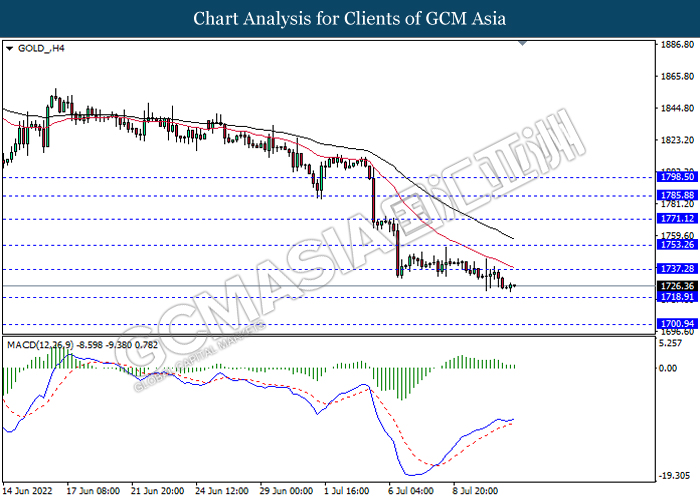

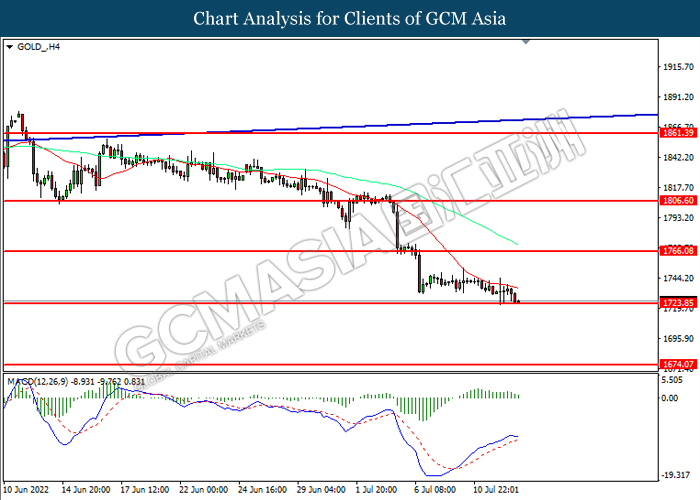

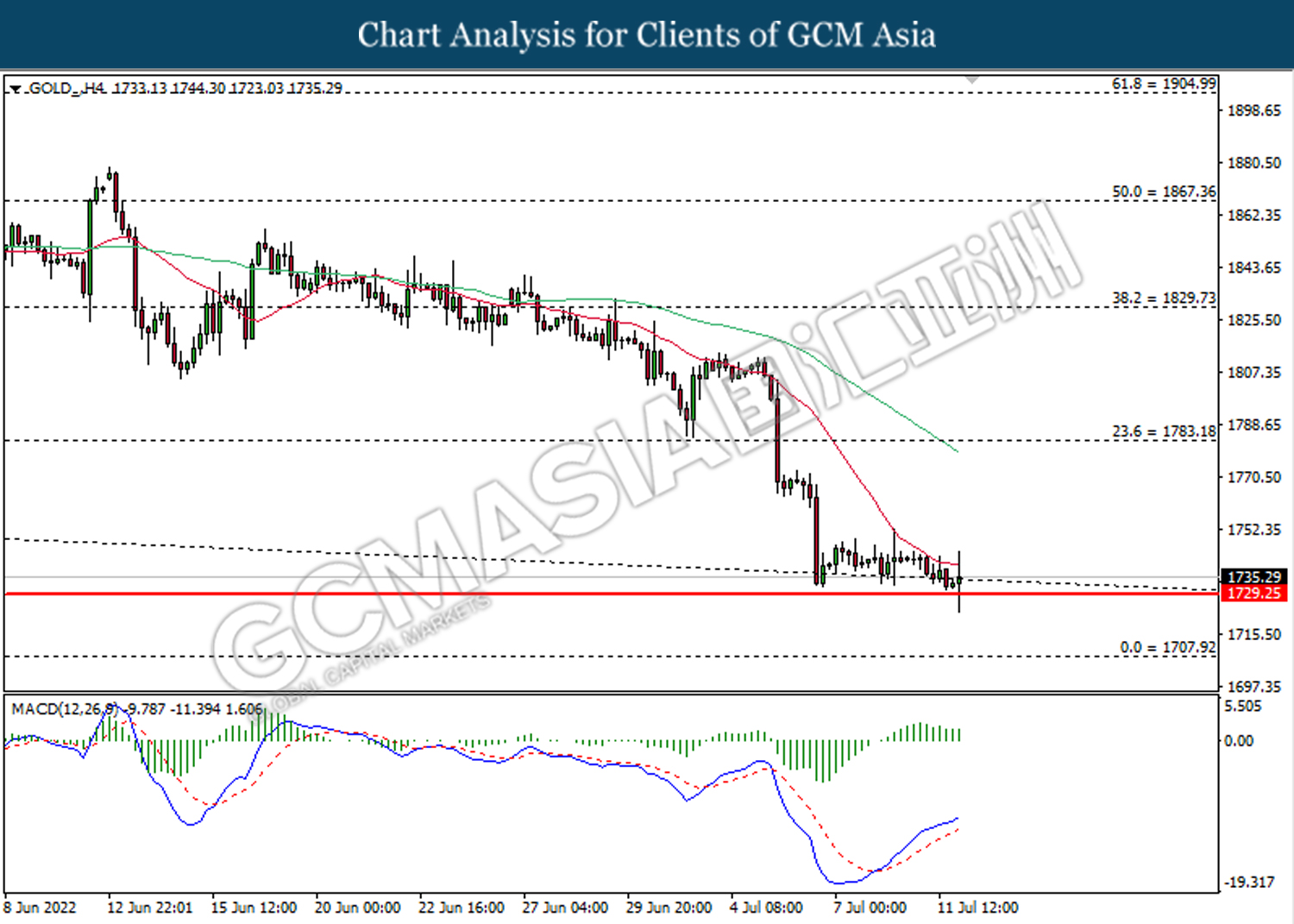

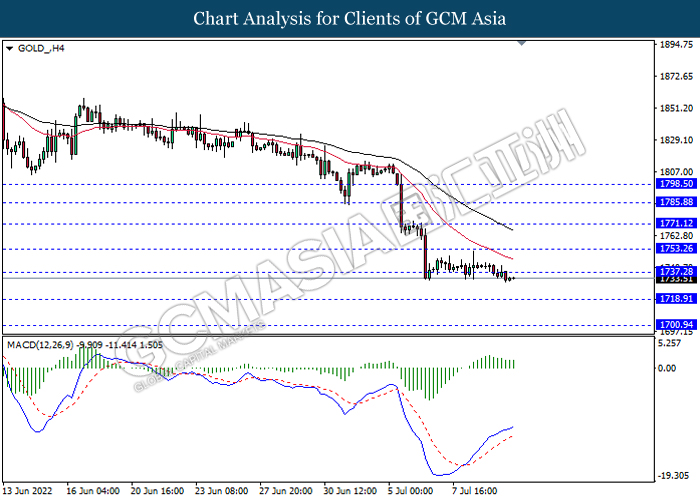

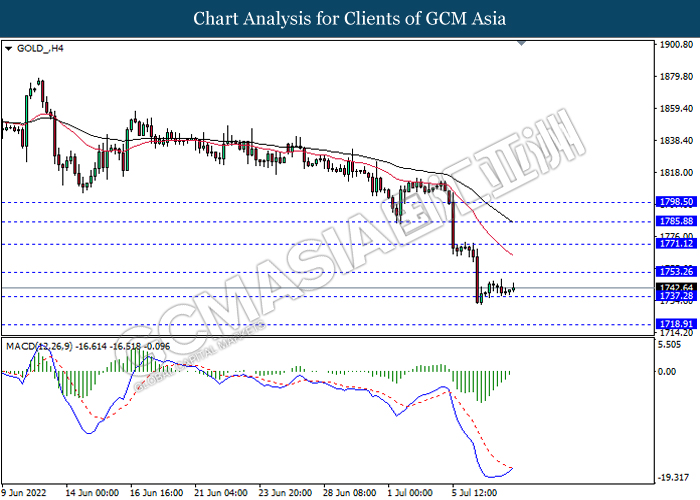

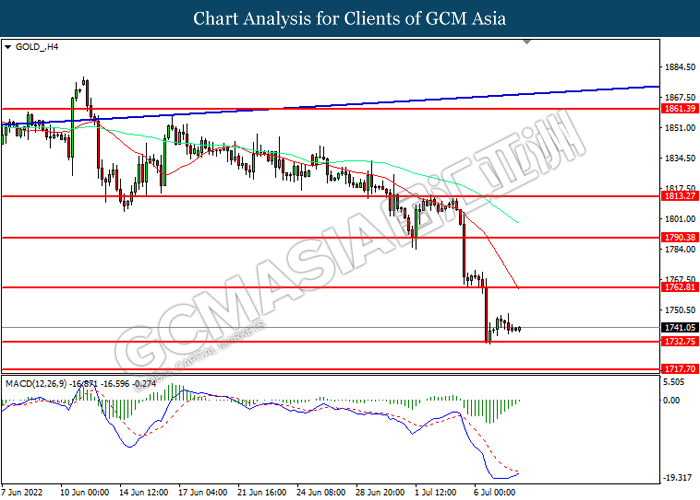

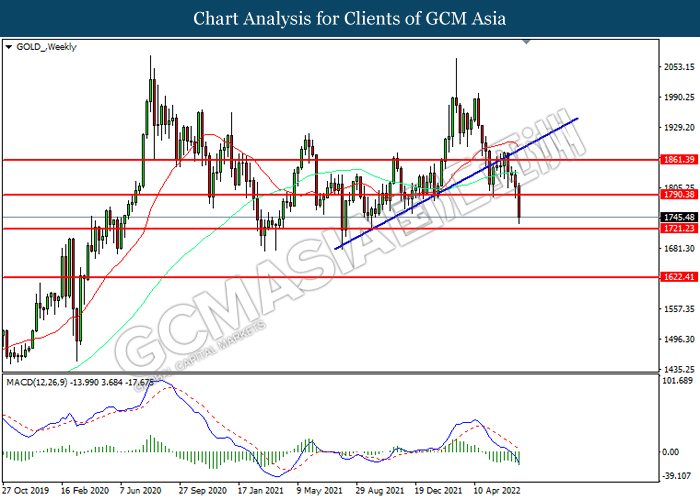

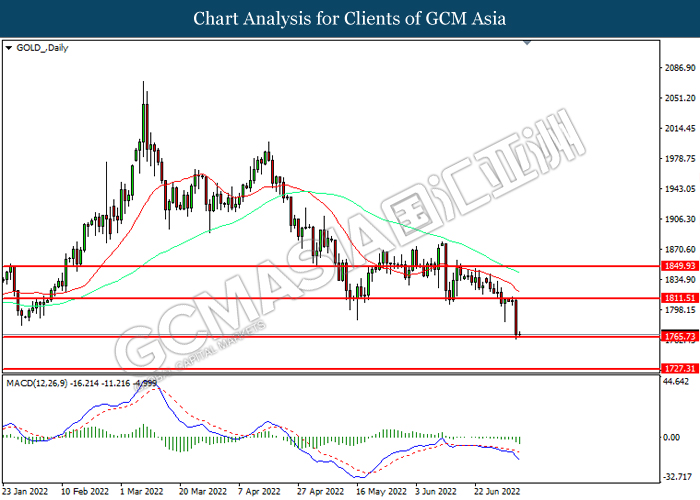

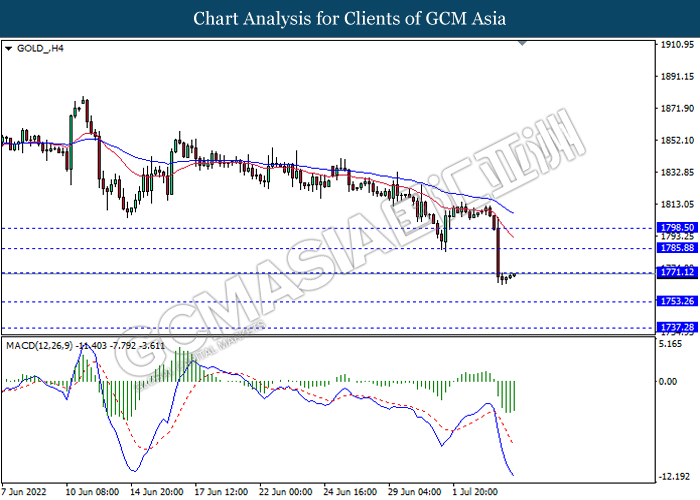

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85

150722 Afternoon Session Analysis

15 July 2022 Afternoon Session Analysis

Geopolitical uncertainty tampered with the sentiment of euro market.

The Euro, which is traded by the majority of investors across the globe, slumped as the rising geopolitical risk in the European region continues to drag down the appeal of the currency. According to Washington Post, Italy hit a period of dizzying political turbulence Thursday, with Prime Minister Mario Draghi saying that he would resign and make way for a new government following the 5-Star movement – the largest party in the country’s coalition government withdrew its support in a parliamentary confidence vote. Investors viewed Prime Minister Mario Draghi as a crucial guarantor of economic stability in the European financial market, such sentiment had triggered further concerns for economic momentum in European. On the other hand, the heightening of market concern over the energy crisis further pressured the value of the single currency, which urged the Europe currency dropped below the parity of 1:1 against the US Dollar. As of writing, the pair of EUR/USD rebounded slightly by 0.07% to 1.0022.

In the commodities market, the crude oil price dropped 0.75% to $92.85 as the appreciation of the US dollar left the oil expensive to buy for global oil buyers. Besides, the gold prices eased by 0.10% to $1712.50 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | 0.5% | 0.6% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | -0.3% | 0.8% | – |

Technical Analysis

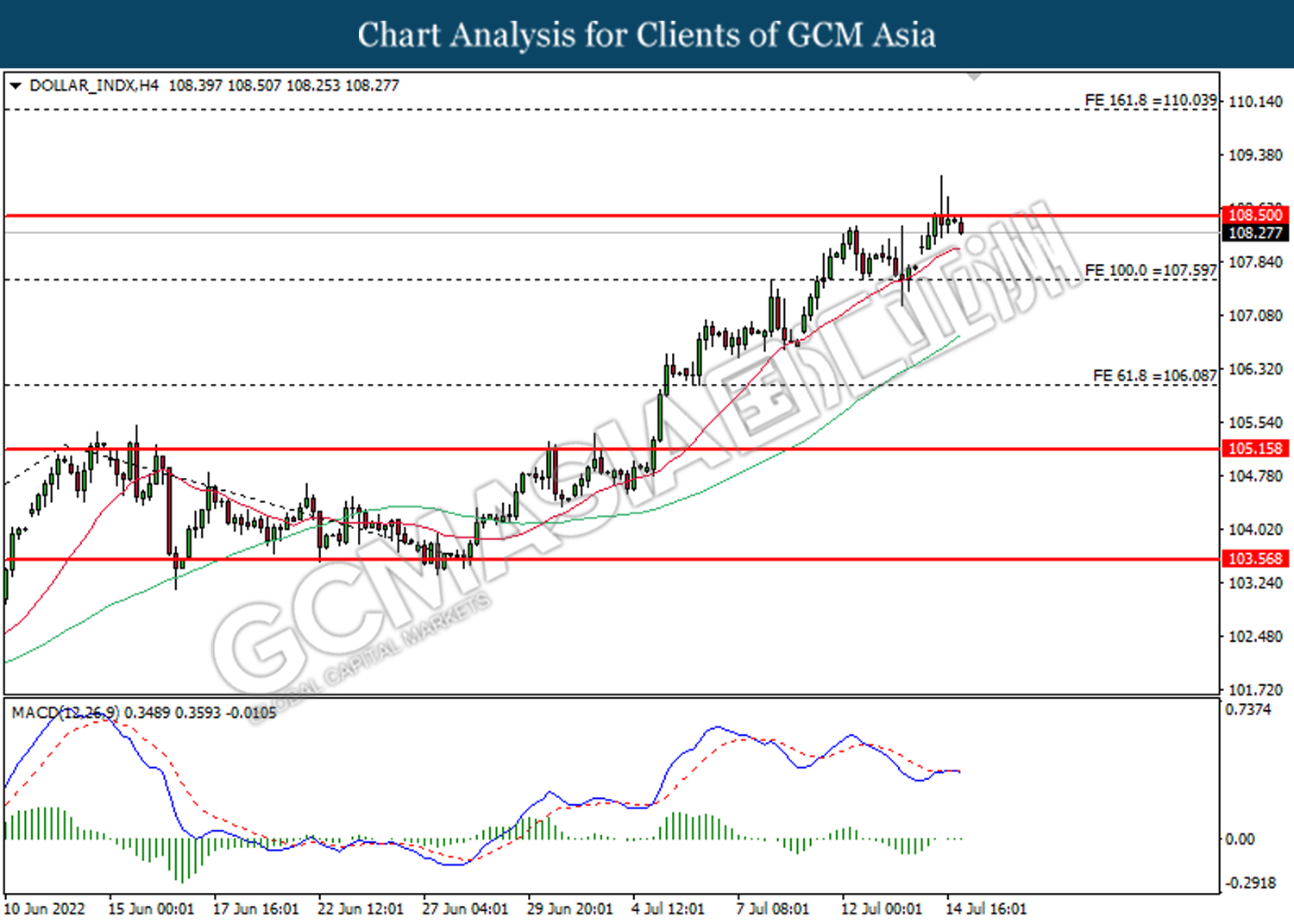

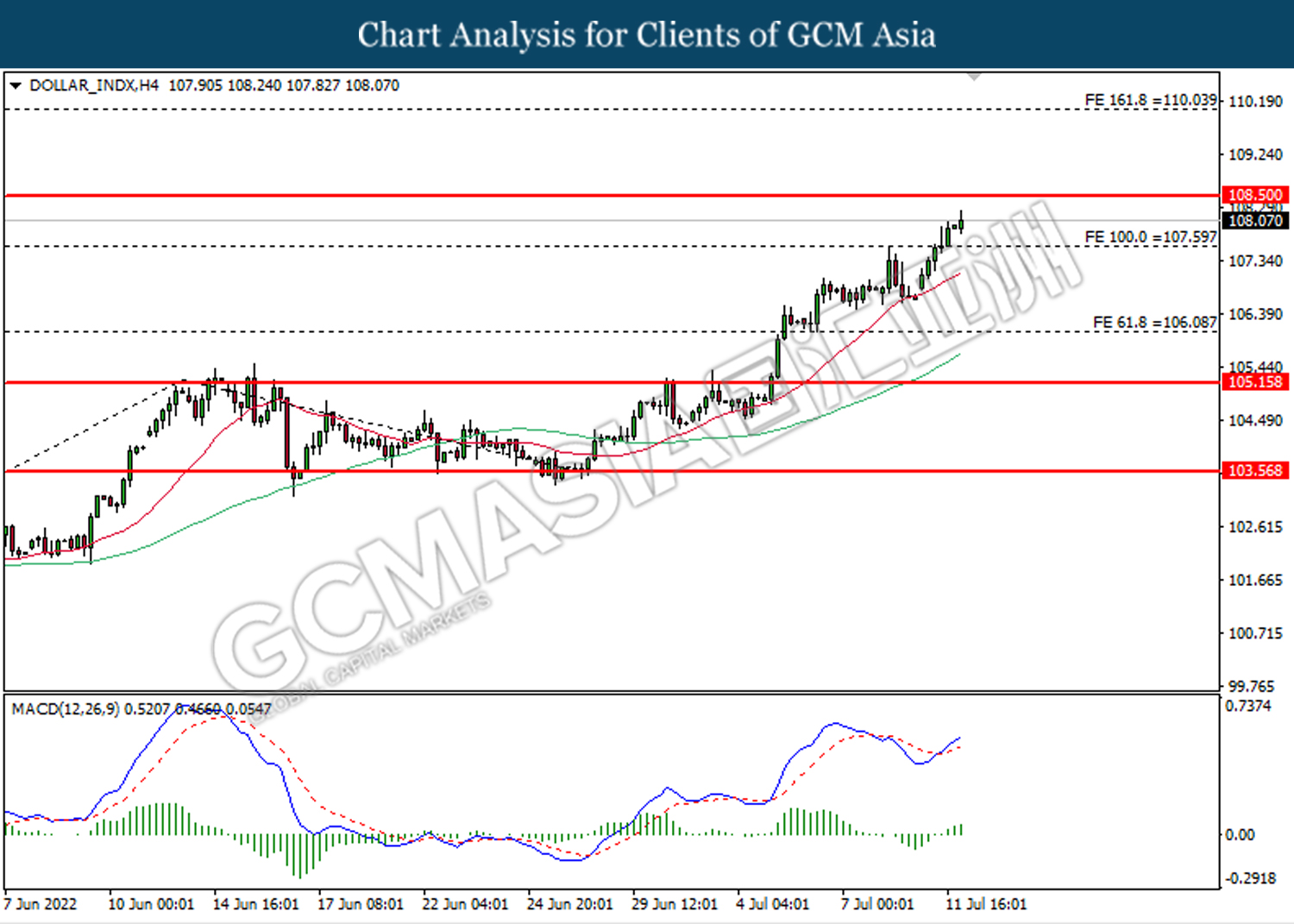

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 108.50. Due to lack of signal from the MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 108.50, 110.05

Support level: 107.60, 106.10

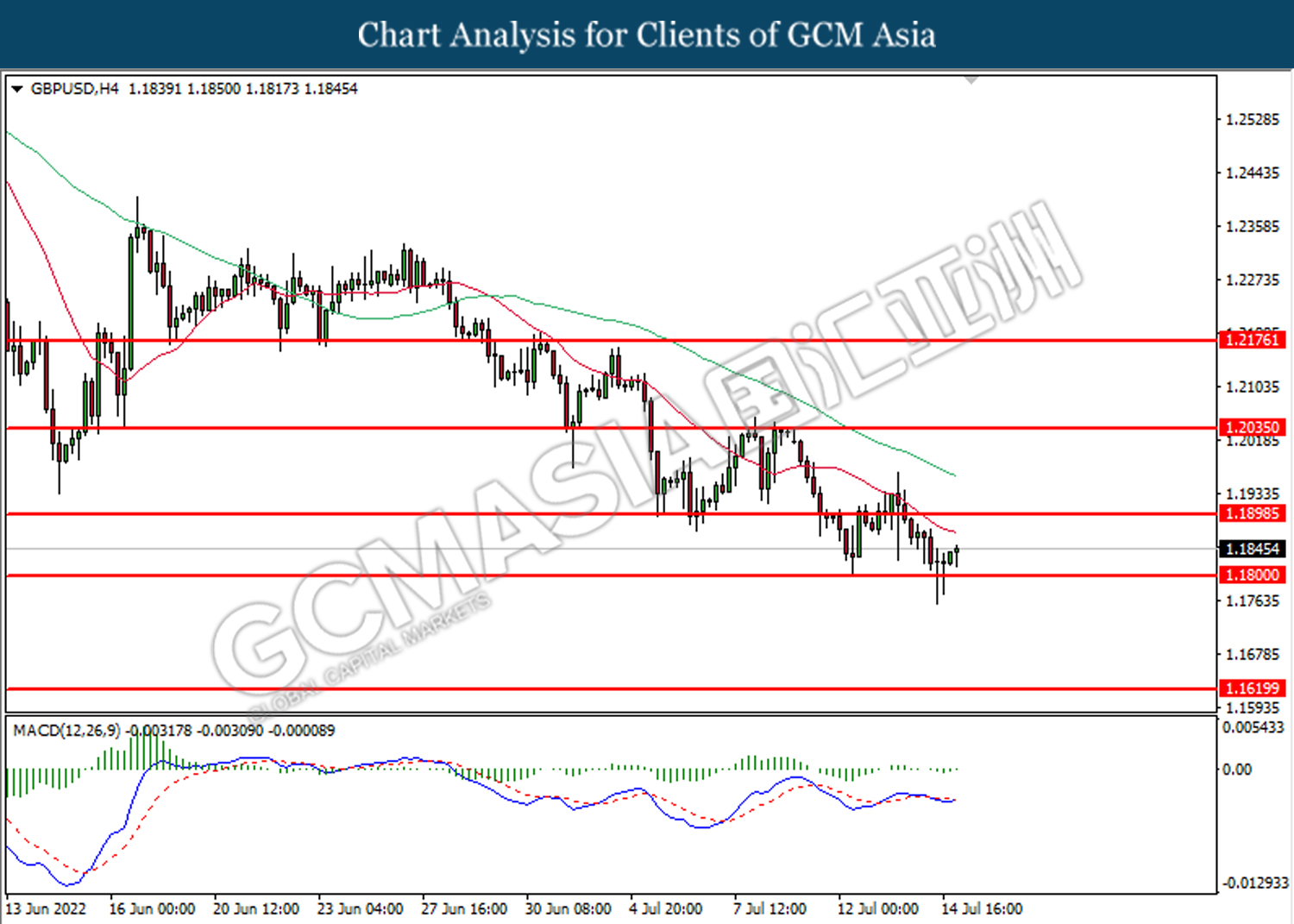

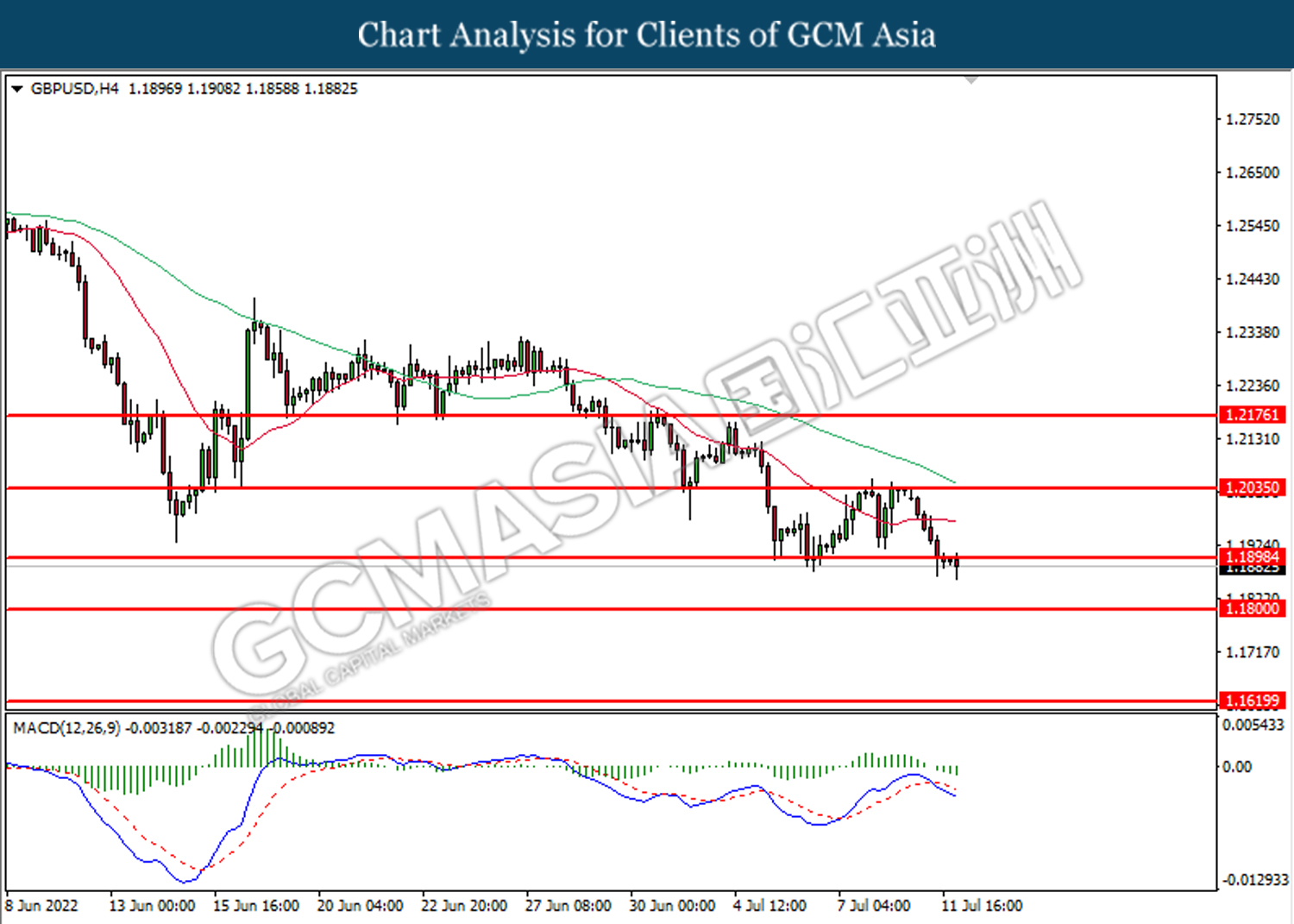

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.1800. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1900.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

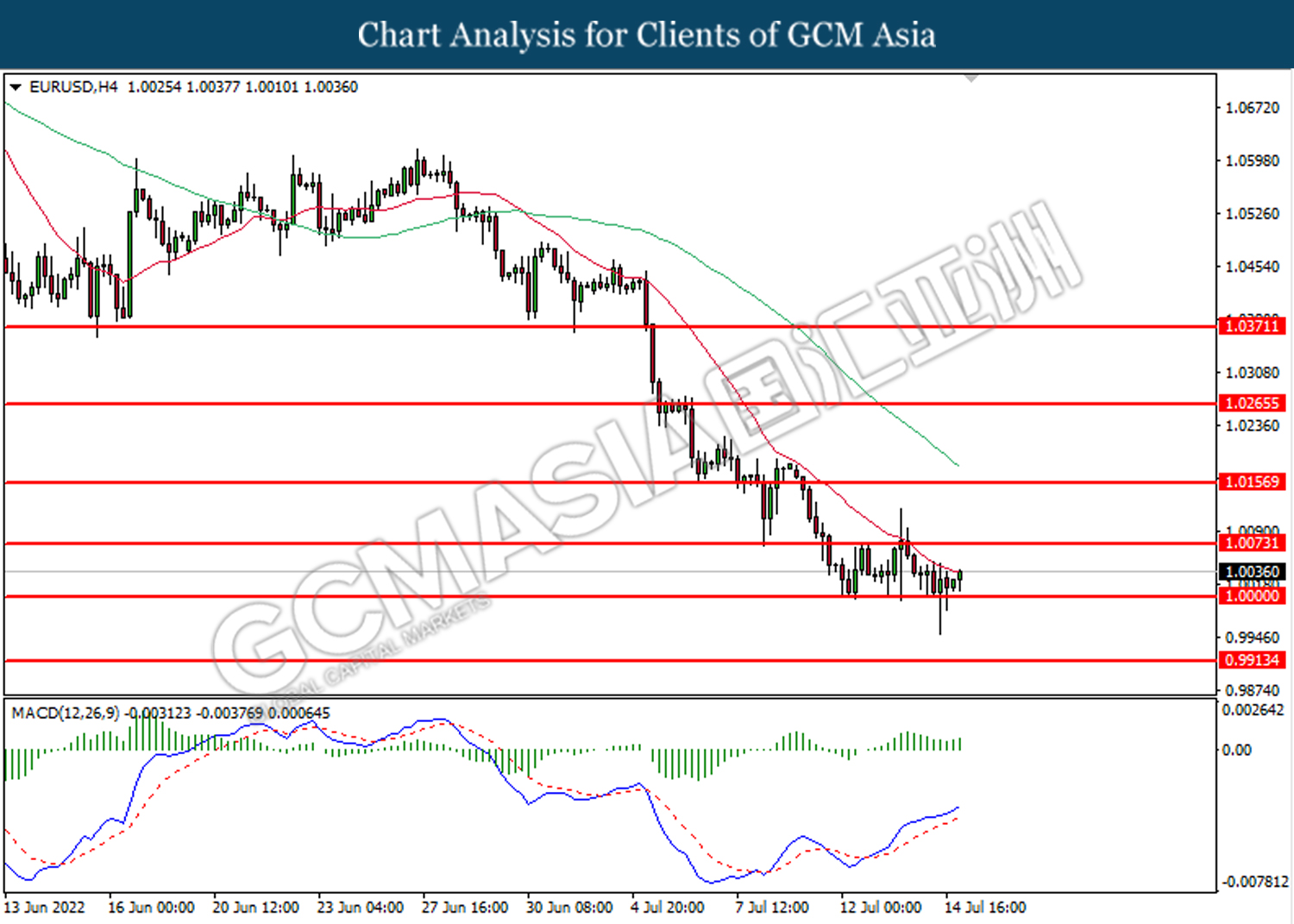

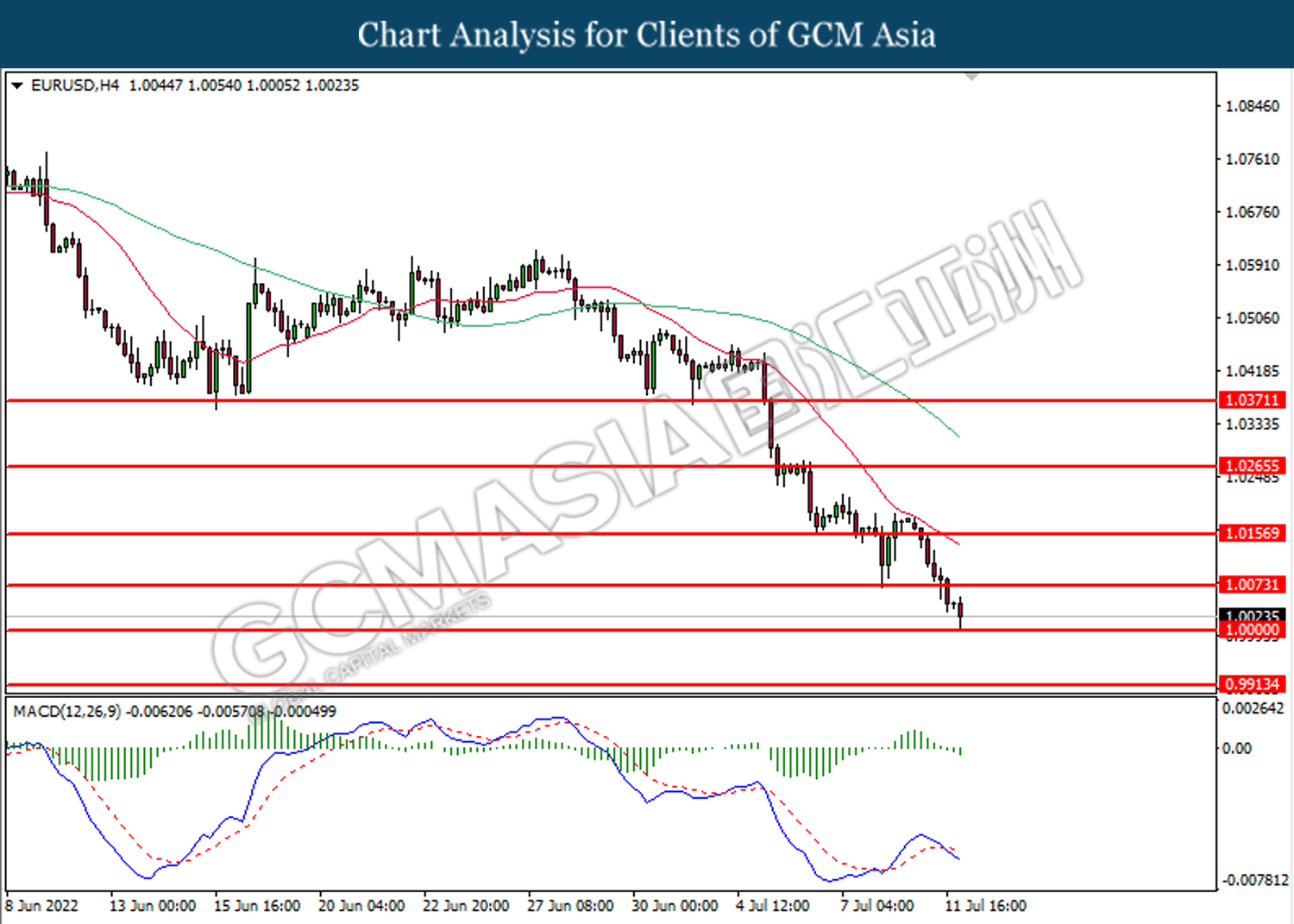

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0075.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

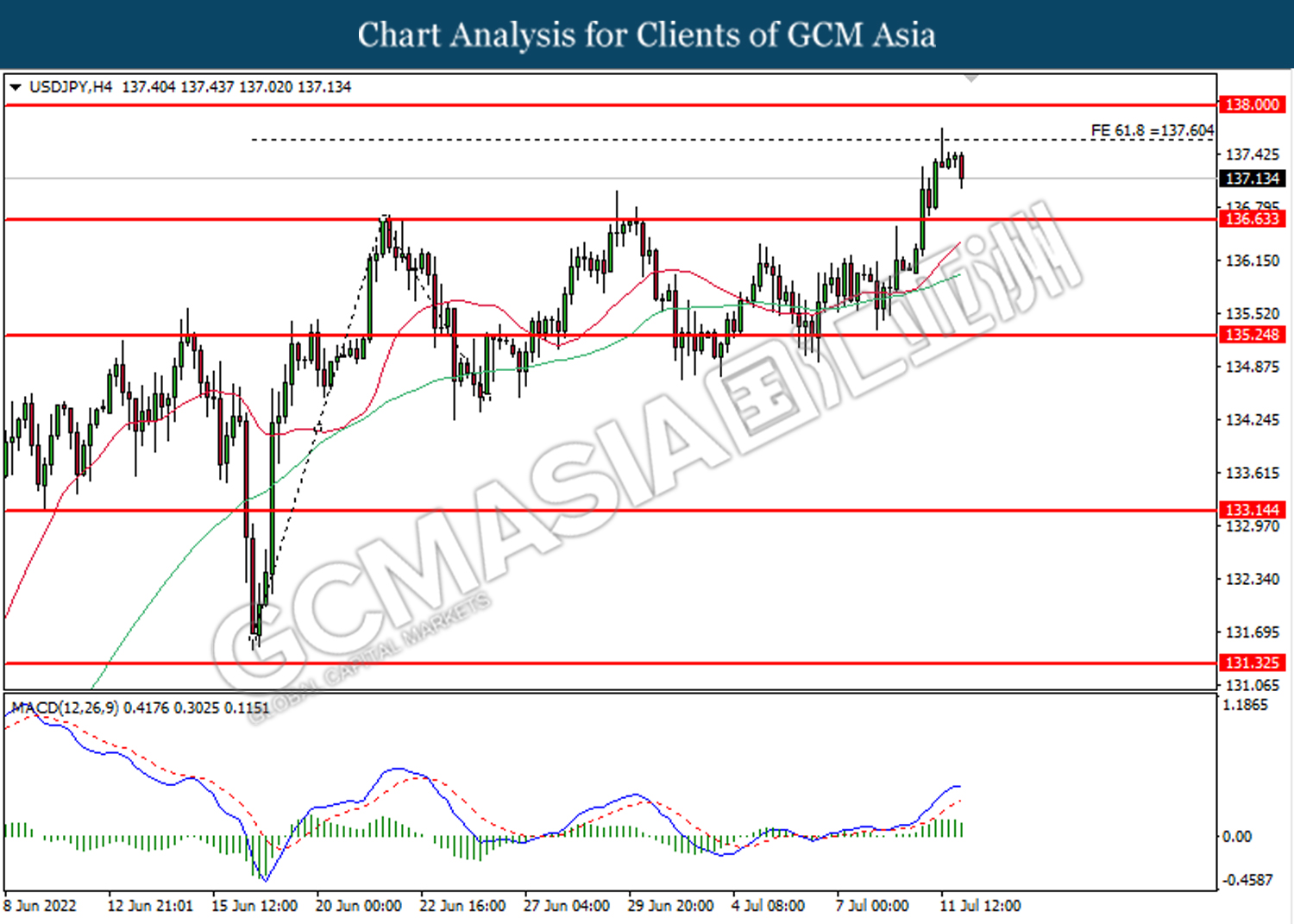

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 139.50. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 138.00.

Resistance level: 139.50, 140.50

Support level: 138.00, 137.60

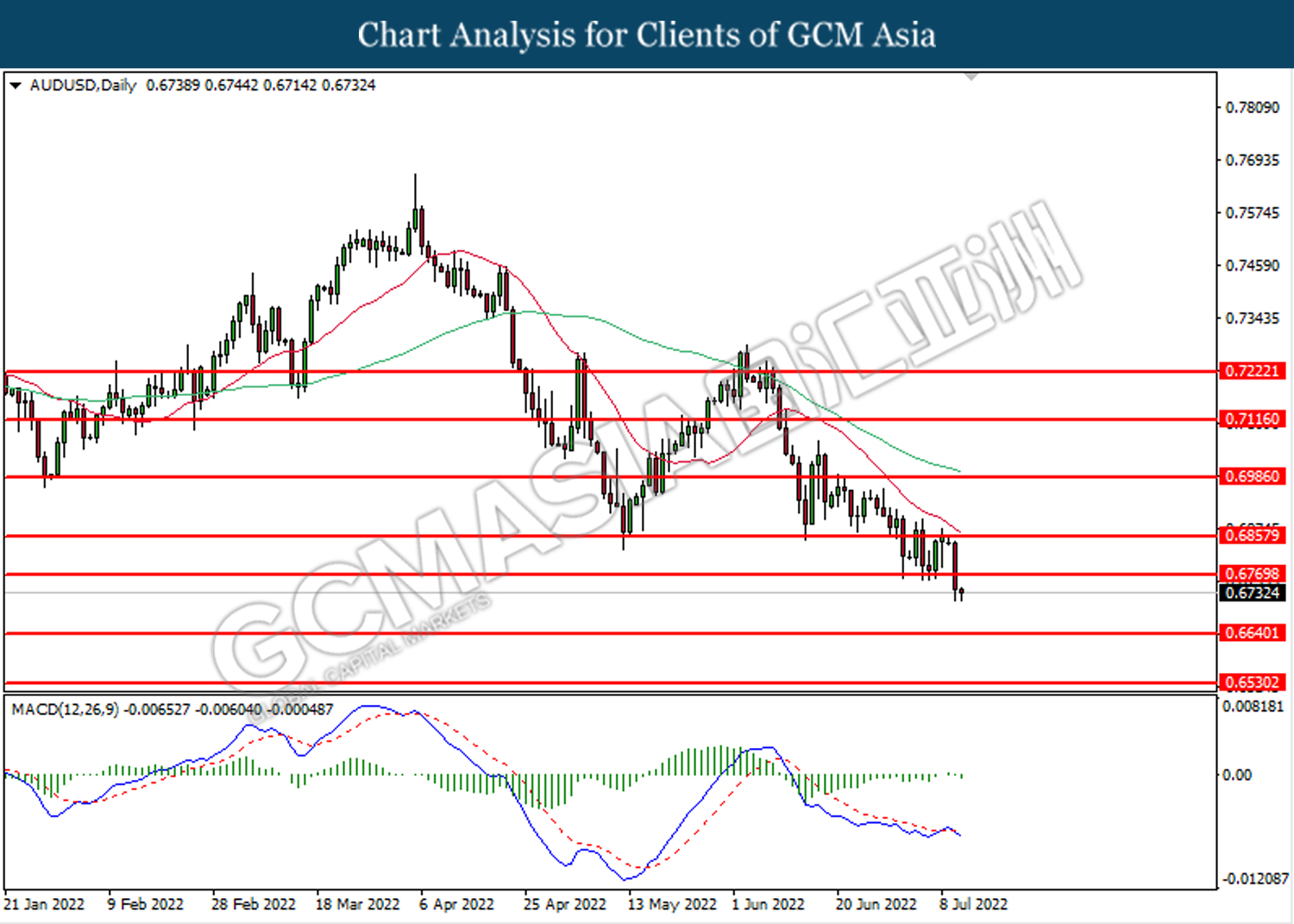

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6770. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6770.

Resistance level: 0.6770, 0.6855

Support level: 0.6640, 0.6530

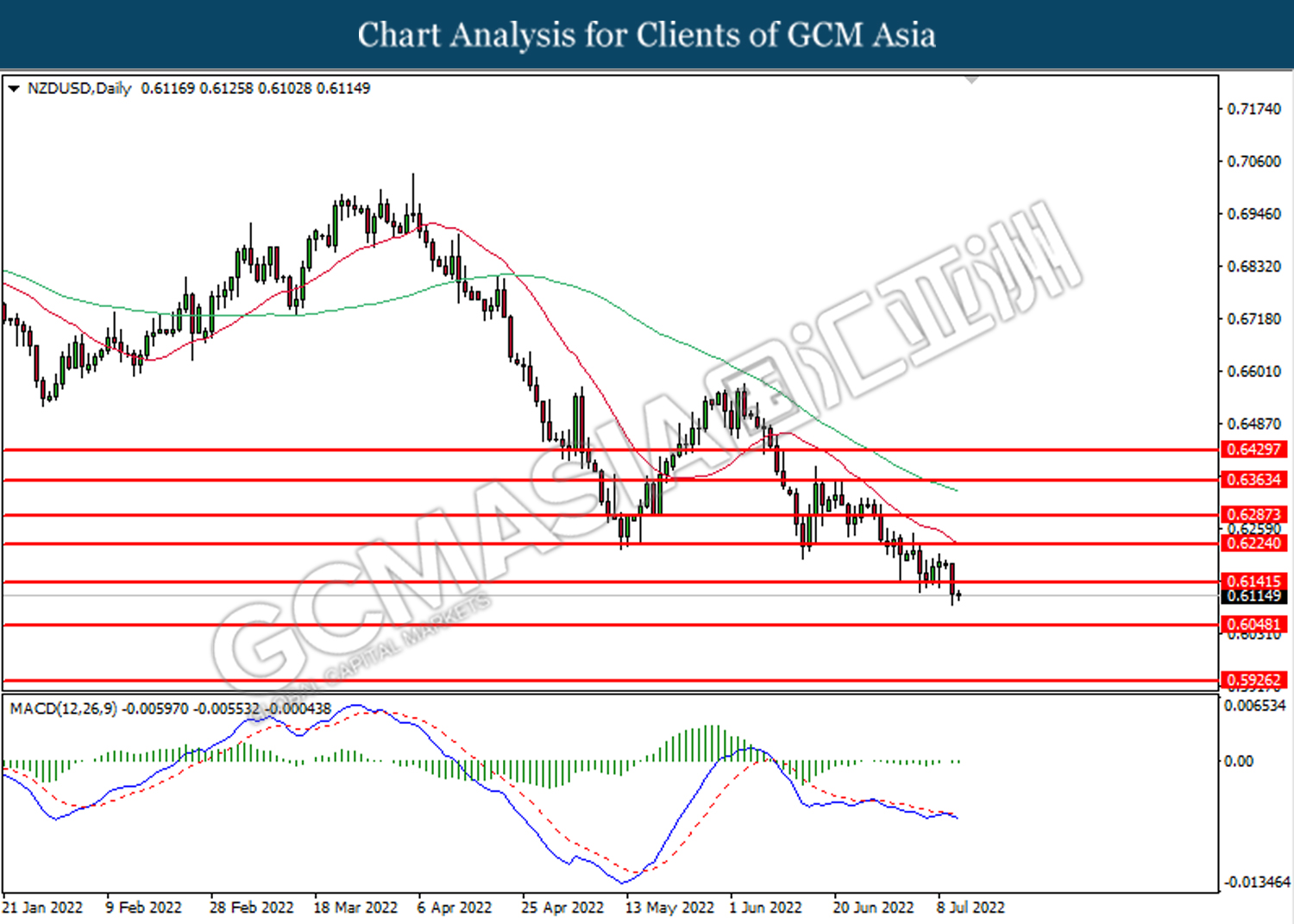

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6140, 0.6225

Support level: 0.6050, 0.5925

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3110. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3050.

Resistance level: 1.3110, 1.3160

Support level: 1.3050, 1.2975

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9825. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9750.

Resistance level: 0.9825, 0.9890

Support level: 0.9750, 0.9665

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 94.05. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 94.05.

Resistance level: 94.05, 98.20

Support level: 89.55, 86.00

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80

150722 Morning Session Analysis

15 July 2022 Morning Session Analysis

US PPI data given a bullish reading, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday after the PPI data has been unleashed. According to the US Department of Labor, the US Producer Price Index (PPI) MoM for June notched up from the previous reading of 0.9% to 1.1%, exceeding the market forecast of 0.8%. The PPI data used to measure the changes of price from the perspective of producer, and was also a major indicator to determine the inflation rate in the US. As the PPI data had given a higher-than-expected reading, it hinted that the spiking inflation risk keep hovering in the US market. Federal Reserve would likely to implement aggressive rate hike in the upcoming meeting to stabilize soaring prices. Nonetheless, the gains experienced by the Dollar Index was limited over the downbeat employment data. The US Initial Jobless Claims came in at the reading of 244K, higher than the economist expectation of 235K. The fragile labor market in the US would likely drag down the economic progression, which spurred bearish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.67% to 108.47.

In the commodities market, crude oil price appreciated by 0.58% to $96.35 per barrel after a sharp decline throughout the overnight session ahead of potential large US rate hike. Besides, gold price edged up by 0.20% to $1709.25 per troy ounce as of writing. However, gold price stayed under pressure following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | 0.50% | 0.60% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | -0.30% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.1870, 1.2010

Support level: 1.1755, 1.1610

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0040, 1.0145

Support level: 0.9950, 0.9860

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.90, 141.00

Support level: 138.60, 137.35

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3165, 1.3240

Support level: 1.3095, 1.3035

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9900, 0.9960

Support level: 0.9820, 0.9740

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 93.55, 97.70

Support level: 88.40, 84.25

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be trade higher as technical correction.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85

140722 Afternoon Session Analysis

14 July 2022 Afternoon Session Analysis

Canada Dollar surged amid rate hike policy.

The Canada Dollar surged significantly following the Bank of Canada unleashed their aggressive contractionary monetary policy to stabilize the spiking inflation rate. Yesterday, the Bank of Canada on Wednesday increased their benchmark interest rate by 100 basis point to 2.5%, surprising the market expectation with its biggest rate hike since 1998. According to its monetary policy statement, the bank of Canada also raised it s near-term inflation forecast to an average 8% in the middle quarters of 2022. The rate hike decision from the central bank had spurred significant bullish momentum on the Canada Dollar. Though, the gains experienced by the Canada Dollar was limited following the central bank downgraded its economic projection, while predicting a sharp slowdown in Canada’s housing market, with that contraction expected to continue until 2023. As of writing, USD/CAD appreciated by 0.06% to 1.2980.

In the commodities market, the crude oil price surged 0.36% to $94.30 per barrel as of writing. The crude oil price rebounded amid technical correction. Though, the overall trend for the crude oil remained bearish amid fears upon recession risk continue to weigh down on this black-commodity. On the other hand, the gold price slumped 0.41% to $1728.55 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 235K | 235K | – |

| 20:30 | USD – PPI (MoM) (Jun) | 0.80% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2035, 1.2190

Support level: 1.1855, 1.1655

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 1.0160, 1.0385

Support level: 1.000, 0.9780

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 139.65, 142.75

Support level: 137.75, 134.45

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6825, 0.7030

Support level: 0.6615, 0.6420

NZDUSD, H4: NZDUSD was traded within a range while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9845, 0.9905

Support level: 0.9750, 0.9685

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it breakout the resistance level.

Resistance level: 95.15, 103.40

Support level: 89.50, 84.05

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1747.10, 1766.10

Support level: 1723.85, 1704.75

140722 Morning Session Analysis

14 July 2022 Morning Session Analysis

US Dollar rallied over the upbeat CPI data.

The dollar Index which traded against a basket of six major currencies rose significantly on yesterday after the CPI data has been released. According to the US Department of Labor, the US Consumer Price Index (CPI) YoY for June notched up from the previous reading of 8.6% to 9.1%, exceeding the market forecast of 8.8%. The CPI data was used to measure the changes of price which paid by the US consumer, which is a crucial indicator to determine the inflation rate. The higher-than-expected of CPI reading hinted that the inflation risk keep soaring in the US market, which rising the odds of aggressive rate hikes from Federal Reserve in the upcoming meeting to stabilize the increasing prices. Besides, according to Reuters, market participants started to ponder 100 basis point increase from Fed after the unleash of CPI data, sparkling the appeal of US Dollar. As of writing, the Dollar Index edged down by 0.05% to 107.85.

In the commodities market, crude oil price depreciated by 0.49% to $95.83 per barrel as of writing. According to Energy Information Administration, the US Crude Oil Inventories increased by 3.254M, higher than the market expectation of -0.154M. On the other hand, gold price depreciated by 0.32% to $1729.90 per troy ounce as of writing amid the backdrop of aggressive rate hikes expectations from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 235K | 235K | – |

| 20:30 | USD – PPI (MoM) (Jun) | 0.80% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1870, 1.2010

Support level: 1.1755, 1.1610

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0040, 1.0145

Support level: 0.9950, 0.9860

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 93.55, 97.70

Support level: 88.40, 84.25

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1737.30, 1753.25

Support level: 1718.90, 1700.95

130722 Afternoon Session Analysis

13 July 2022 Afternoon Session Analysis

US Dollar rallied upon economy recession fears.

The Dollar Index which traded against a basket of six major currencies rose on Tuesday amid the soaring fears of global economic slowdown. According to Reuters, hundreds of thousands of people were under lockdown in a small China city on Tuesday after just one case of Covid-19 was detected. As China stands with its zero-Covid policy, the government of China has to implement the lockdown to tamp down the spread of the Covid variant. Nonetheless, the implementation of lockdown would likely drag down the economic progression in China, which stoked a shift in sentiment toward safe-haven assets such as US Dollar. Besides, the overall trend of Dollar Index remained bullish following the rising expectation of rate hikes from Federal Reserve. According to CME FedWatch Tool, possibility of 75 basis point increase has reached 91.2%. In addition, investors would continue to focus on the CPI data which will be released tonight in order to gauge the likelihood movement of Dollar Index. As of writing, the Dollar Index appreciated by 0.11% to 108.02.

In the commodities market, crude oil price edged up by 0.17% to $96.00 per barrel after the sharp decline throughout the overnight session over the diminishing demand for oil which was driven by China’s lockdown. On the other hand, gold price appreciated by 0.05% to $1725.70 per troy ounce as of writing. However, gold price stayed under heavy pressure following the strengthening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.70% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM) (May) | -1.00% | 0.10% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.20% | – | – |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.60% | 0.60% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 8.60% | 8.80% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.50% | 2.25% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0040, 1.0145

Support level: 0.9950, 0.9860

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to be extend its gains if successfully breakout the resistance level.

Resistance level: 93.55, 97.70

Support level: 88.40, 84.25

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1737.30, 1753.25

Support level: 1718.90, 1700.95

130722 Morning Session Analysis

13 July 2022 Morning Session Analysis

Euro slumped amid bearish economic data.

The Euro slumped significantly over the backdrop of bearish economic data yesterday. According to ZEW, Germany ZEW Economic Sentiment notched down significantly from the previous reading of -28.0 to -53.8, missing the market forecast at -38.3. Market participants remained concerns upon the energy crisis in Germany as well as the rate hike decision from European Central Bank to stabilize the inflation risk would continue to dampen the economic outlook in European region. Besides, economists predicted the current economic situation significantly more pessimistic compare to previous month and have further lowered their GDP forecast in future. In addition, the Euro extend its losses following some cities in China re-impose partial lockdowns amid the resurgence of Covid-19 cases, which stoked a shift in sentiment toward other safe-haven asset such as US Dollar. As of writing, EUR/USD depreciated by 0.06% to 1.0030.

In the commodities market, the crude oil price slumped 1.57% to $91.80 per barrel as of writing. According to American Petroleum Institute (API), the crude oil inventories notched up from the previous reading of 3.825M to 4.762M, higher than the market forecast -1.933M. On the other hand, the gold price depreciated by 0.04% to $1725.00 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.70% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM) (May) | -1.00% | 0.10% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.20% | – | – |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.60% | 0.60% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 8.60% | 8.80% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.50% | 2.25% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2035, 1.2190

Support level: 1.1855, 1.1655

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0160, 1.0385

Support level: 0.9940, 0.9780

USDJPY, H4: USDJPY was traded lower higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.70, 140.95

Support level: 134.45, 131.40

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6825, 0.7030

Support level: 0.6615, 0.6420

NZDUSD, H4: NZDUSD was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9875, 0.9980

Support level: 0.9795, 0.9715

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 95.15, 101.25

Support level: 89.60, 84.55

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1766.10, 1806.60

Support level: 1723.85, 1674.05

120722 Afternoon Session Analysis

12 July 2022 Afternoon Session Analysis

Euro dived, approaching toward parity with dollar.

The Euro, which is traded by the majority of investors across the globe, slumped significantly this morning as investors put a bet on the Euro dollar parity for the first time in 20 years. In fact, the single currency – The euro has been receiving tremendous bearish momentum since the initiation of the Russo-Ukrainian war. Despite Europe did not have the immediacy of involvement in the war, the sanctions initiated by the Eurozone have put themselves on the edge of the hill, where an energy crisis tipped the region into a recession. Back to a few months ago, Russia cut 60% of the natural gas flow to Germany through Nord Stream 1. While the tensions between Ukraine and Russia heightened, the concerns that an energy crisis would happen in the region increased as well. On the other side, the pair of EUR/USD slumped further as the US currency was boosted by the expectations that the Federal Reserve will hike rates faster and further than peers. As of writing, the pair of EUR/USD is down 0.14% to 1.0025.

In the commodities market, the crude oil price was down by 0.56% to $100.30 as the rising of Covid-19 cases in China is expected to derail the recovery path of the nation. Besides, the gold prices dived 0.03% to $1734.40 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

|

Time |

Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Jul) | -28.0 |

-38.3 |

– |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 107.60. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 108.50.

Resistance level: 108.50, 110.05

Support level: 107.60, 106.10

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.1900. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 137.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 136.65.

Resistance level: 137.60, 138.00

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6770. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6770, 0.6855

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6225

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2975. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3050.

Resistance level: 1.3050, 1.3110

Support level: 1.2975, 1.2910

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9825. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9825, 0.9890

Support level: 0.9750, 0.9665

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 101.85. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 98.20.

Resistance level: 101.85, 106.60

Support level: 98.20, 94.05

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1783.20.

Resistance level: 1783.20, 1829.75

Support level: 1729.25, 1707.90

120722 Morning Session Analysis

12 July 2022 Morning Session Analysis

US Dollar rose amid the rising inflation expectation.

The Dollar Index which traded against a basket of six major currencies surged over the rising expectation of inflation risk. According to US Department of Labor, the US Consumer Price Index (CPI) YoY for June that forecasted by economist has reached 8.8%, which higher than the previous reading of 8.6%. The CPI data was used to measure the monthly change in prices paid by consumers, which is the major indicator to determine the inflation rate. As the economist had given a higher-than-previous reading for the CPI data, it would likely to hint that the soaring inflation risk keep hovering in the US. The Federal Reserve might implement aggressive contractionary monetary policy in order to stabilize the inflation, which sparkling the appeal of US Dollar. Nonetheless, investors would continue to scrutinize the latest updates with regards of the unleash of CPI data on tomorrow in order to receive further trading signals. As of writing, the Dollar Index appreciated by 1.12% to 108.02.

In the commodities market, crude oil price eased by 1.14% to $102.90 per barrel as of writing following China reported its first case of the highly-transmissible Omicron subvariant, which might lead to a lockdown. Besides, gold price edged up by 0.03% to $1732.25 per troy ounce as of writing. However, the overall trend of gold price remained bearish amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Jul) | -28 | -38.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0145, 1.0235

Support level: 1.0040, 0.9950

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower a technical correction.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 0.9960

Support level: 0.9820, 0.9740

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1737.30, 1753.25

Support level: 1718.90, 1700.95

080722 Afternoon Session Analysis

8 July 2022 Afternoon Session Analysis

BoJ remained its dovish statement, USDJPY rose.

The USD/JPY edged up on yesterday amid the backdrop of dovish statement of Bank of Japan (BoJ). According to Reuters, BoJ was expected to raise its inflation forecast, which the core consumer inflation adjusted to 2% target in the current fiscal year ending in March 2023, up from the present forecast of 1.9% made in April. Nonetheless, the BoJ Governor Haruhiko Kuroda claimed that the central bank would remain its expansionary monetary policy as the inflation in Japan still lower than other western countries. Besides, BoJ also lowered its economic growth forecast from the current 2.9%. The bearish economic growth expectation might indicate that the diminishing of consumer spending in Japan, which reduced the odds of rate hike from BoJ. Though, the movement of USD/JPY is relatively slower throughout the overnight trading session as investors are eyeing on the NFP data which would be released tonight. As of writing, USD/JPY appreciated by 0.03% to 136.00.

In the commodities market, crude oil price depreciated by 0.88% to $101.85 per barrel as of writing following the economy recession sentiment keep lingering in the market. On the other hand, gold price appreciated by 0.10% to $1741.55 per troy ounce as of writing. However, the overall trend of gold price remained bearish amid the rising of rate hike expectation from major central banks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:55 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 390K | 270K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jun) | 39.8K | 22.5K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 106.95, 107.70

Support level: 105.90, 105.25

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2115, 1.2190

Support level: 1.2010, 1.1870

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0235, 1.0315

Support level: 1.0145, 1.0040

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be trade lower as technical correction.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1753.25, 1771.10

Support level: 1737.30, 1718.90

080722 Morning Session Analysis

08 July 2022 Morning Session Analysis

US Dollar seesawed ahead of Nonfarm Payroll.

The Dollar Index which traded against a basket of six major currencies was traded flat ahead of the released of crucial economic data from US region. Recently, fears upon the recession risk continue to linger in the global financial market, the retail Sales and real spending in the United States were indicated pessimism reading in May. The Federal Open Market Committee (FOMC) are expected to add another 75-basis point during the 27th July meeting, bringing the target interest rate to 2.50% in order to stabilize the significant inflation risk. The Nonfarm Payroll. which would be releasing tonight is crucial as the labor market is the crucial factor which would affect the decision making of the monetary policy. When hiring process began to fade, the odds toward the recession risk would be higher. The earlier statistic had indicated that the Nonfarm Payrolls data have seen the three-month average decrease from the previous reading of 602,000 in February to 408,000 in May, and the economists forecasted that the data would continue its downward trend into 270,000 job creation in June. Indeed, the Atlanta Fed’s GDPNow model predicted the second-quarter growth in United States would fall into further contraction. As of writing, the Dollar Index depreciated by 0.06% to 107.05.

In the commodities market, the crude oil price appreciated by 0.10% to $102.25 per barrel as of writing amid technical correction. Though, the gains experienced by the crude oil was still limited by bearish inventory data. According to Energy Information Administration (EIA), Crude Oil Inventories came in at 8.235M, exceeding the market forecast at -1.043M. On the other hand, gold price was traded flat at $1739.30 while investors continue to scrutinize the latest job data tonight.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:55 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 390K | 270K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jun) | 39.8K | 22.5K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2190, 1.2400

Support level: 1.1925, 1.1660

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0385, 1.0575

Support level: 1.0185, 1.0060

USDJPY, H4: USDJPY was traded lower higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6875, 0.6990

Support level: 0.6760, 0.6615

NZDUSD, H4: NZDUSD was traded within a range while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9715, 0.9780

Support level: 0.9625, 0.9510

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 103.40, 111.65

Support level: 95.15, 84.55

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1790.40, 1861.40

Support level: 1721.25, 1622.40

070722 Afternoon Session Analysis

07 July 2022 Afternoon Session Analysis

Euro slumped amid recession risk linger in market.

The Euro extends its losses significantly on yesterday following Germany posted its first foreign trade deficit in more than three decades, spurring further fears upon the recession risk in the financial market. According to the latest data, Germany posted a foreign trade deficit of 1 billion euros, its first monthly trade deficit since 1911. Earlier, its high level of exports had been a crucial economic booster in the Germany, such negative reading would likely to add further tensions for the economic momentum. Germany’s exports in May were still notched up by 11.7% compared to a year ago, according to the country’s statistics office, though 0.5% lower from the previous month. Though, the cost for the import went up by 27.8% from a year ago as rising commodities prices continue to trigger further cost for the country. Germany has been paying more for energy and food since the tensions between Russia-Ukraine intensified while the implementation of sanction continues to jeopardize the economic growth. As of writing, EUR/USD depreciated by 0.01% to 1.0200.

In the commodities market, the crude oil price appreciated by 0.89% to $99.05 per barrel as of writing amid technical correction. Though, the overall trend for the crude oil still remained bearish amid the recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold price depreciated by 0.01 to $1745.00 amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 231K | 230K | – |

| 22:00 | CAD – Ivey PMI (Jun) | 72.0 | – | – |

| 23:00 | USD – Crude Oil Inventories | -2.762M | -0.569M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2190, 1.2400

Support level: 1.1235, 1.1660

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0385, 1.0575

Support level: 1.0185, 1.0060

USDJPY, H4: USDJPY was traded lower higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6875, 0.6990

Support level: 0.6760, 0.6615

NZDUSD, H4: NZDUSD was traded within a range while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9715, 0.9780

Support level: 0.9625, 0.9510

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 103.40, 111.65

Support level: 95.15, 84.55

GOLD_, Weekly: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1790.40, 1861.40

Support level: 1721.25, 1622.40

070722 Morning Session Analysis

7 July 2022 Morning Session Analysis

Fed emphasized the needs of rate hike, US Dollar surged.

The Dollar index which traded against a basket of six major currencies extended its gains following the hawkish statement from Federal Reserve. According to the FOMC meeting minutes in the earlier day, Federal Reserve officials reiterated the needs of implementation of rate hike despite it would likely lead to the economy recession in the US. Besides, the officials also claimed that the 50 or 75 basis point increase is suitable in order to meet their objective, which controlling the inflation in 2% in long-run. Besides, the Dollar Index received further bullish momentum amid the upbeat economic data. The US ISM Non-Manufacturing Purchasing Managers Index (PMI) for June came in at the reading of 55.3 while higher than the market expectation of 54.3. In addition, the US JOLTs Job Openings for May recorded at the reading of 11.254M, exceeding the market forecast of 11.000M. The bullish economic data had brought positive prospects toward the economic progression in US. As of writing, the Dollar Index rose by 0.53% to 106.88.

In the commodities market, crude oil price depreciated by 0.20% to $98.33 per barrel as of writing as the API Weekly Crude Oil Stock increased while confounding expectations for a decline. On the other hand, gold price edged up by 0.07% to $1737.80 per troy ounce after a sharp decline throughout the overnight trading session following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 231K | 230K | – |

| 22:00 | CAD – Ivey PMI (Jun) | 72.0 | – | – |

| 23:00 | USD – Crude Oil Inventories | -2.762M | -0.569M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 106.95, 107.70

Support level: 105.90, 105.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0235, 1.0315

Support level: 1.0145, 1.0040

USDJPY, H4: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1753.25, 1771.10

Support level: 1737.30, 1718.90

060722 Afternoon Session Analysis

06 July 2022 Afternoon Session Analysis

Energy crisis continue to crush European economy.

The Euro slumped into 20 years low amid the Eurozone recession fears were exacerbated by concerns about an energy crisis in Europe and by Tuesday’s crucial economic data, which fared a sharp slowdown in business growth in June. Currently, the Europe region is facing its biggest energy crisis in decades, with the rising tensions over the war in Ukraine and the implementation of sanction from Russia. Besides, Germany’s cabinet on Tuesday rushed through legislation allowing it to rescue struggling energy companies, in an effort to prevent supply crunch from seeping into the broader economy. The surging cost of gas would lead to significant stagflation risk in future, adding further tensions for the living costs. In addition, the rate hike expectation from Federal Reserve during the FOMC’s July meeting continue to prompt investors to shift their portfolio from the European region into United States, spurring further bearish momentum on the pair of EUR/USD. As of writing, EUR/USD depreciated by 0.01% to 1.0265.

In the commodities market, the crude oil price depreciated by 0.03% to $100.80 per barrel as of writing. The oil market received significant bearish momentum amid rising recession risk in the global financial market continue to drag down the appeal for this black-commodity. On the other hand, the gold price fall amid hawkish expectation from central bank sparked further selloff for gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Jun) | 56.4 | 55.0 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jun) | 55.9 | 54.5 | – |

| 22:00 | USD – JOLTs Job Openings (May) | 11.400M | 11.050M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2190, 1.2400

Support level: 1.1935, 1.1660

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0385, 1.0575

Support level: 1.0205, 1.0060

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6875, 0.6990

Support level: 0.6760, 0.6615

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9715, 0.9780

Support level: 0.9625, 0.9510

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 103.40, 107.60

Support level: 98.70, 95.20

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1811.50, 1849.95

Support level: 1765.75, 1727.30

060722 Morning Session Analysis

6 July 2022 Morning Session Analysis

Recession sentiment keep lingering in the market, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies skyrocketed on Tuesday amid the backdrop of the rising market concern on economy recession. According to Bloomberg, the war-driven inflation in several countries had reach its all-time high, which brought negative prospects toward economic progression of the countries. Despite the major central banks had emphasized that they would likely to implement aggressive rate hike in order to bring down the spiking inflation, the aggressive move might also bring other side effects such as stagflation risk as the rate hike would likely to increase the borrowing cost of consumers. Thus, it prompted investors to shift their capitals toward safe-haven assets such as US Dollar. Besides, the market participants are also eyeing on the interest rate decisions from Federal Reserve in the upcoming meeting as Fed had vowed that they would take forcefully actions to tackle inflation if necessary, which sparkling the appeal of US Dollar. As of writing, the Dollar Index surged by 1.34% to 106.31.

In the commodities market, crude oil price appreciated by 1.42% to $100.91 per barrel after a sharp decline throughout the overnight trading session over the market recession fears which dragged down the oil demand. On the other hand, gold price edged up by 0.16% to $1766.70 per troy ounces as of writing. Nonetheless, gold price slumped on yesterday following the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Jun) | 56.4 | 55.0 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jun) | 55.9 | 54.5 | – |

| 22:00 | USD – JOLTs Job Openings (May) | 11.400M | 11.050M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 106.95, 107.70

Support level: 105.90, 105.25

GBPUSD, H4: GBPUSD was traded lower following prior breakout the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0315, 1.0385

Support level: 1.0235, 1.0145

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend it gains.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1771.10, 1785.90

Support level: 1753.25, 1737.30