140622 Morning Session Analysis

14 June 2022 Morning Session Analysis

Pound dived as the UK GDP shrank in April.

The Pound, which was widely traded by the global investors, was being thrown off by market participants after a series of downbeat data spurred the slowdown fears in the UK. According to the Office of National Statistics, UK GDP contracted by -0.3%, weaker than the consensus forecast at 0.1%, mirroring that the UK economy remains fragile. The contraction of GDP could be mainly attributed to the increases in the cost of production, which affected most of the businesses in the UK. Besides, the Manufacturing Production data in the UK has further solidified the statement that the UK Economy is staring at both a recession and stagflation. According to the same institution (ONS), the country’s manufacturing production declined by -1.0%, missing the consensus forecast of a 0.2% growth. Despite the slowdown figure, the Bank of England (BoE) is expected to raise its interest rate for the fifth time since December 2021 in the upcoming BoE meeting. With that being said, a dovish statement could be foreseen in the post-meeting conference as the UK economic growth has shown a sharp contraction in the recent month. As of writing, the pair of GBP/USD rebounded 0.2% to 1.2135.

In the commodities market, the crude oil price was down by 0.16% to $121.25 amid the ongoing tight supply situation that continued to support the black commodity price. Besides, the gold price up 0.10% to $1820.85 per troy ounce after falling tremendously during the overnight session amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Apr) | 7.0% | 7.6% | – |

| 14:00 | GBP – Claimant Count Change (May) | -56.9K | -42.5K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Jun) | -34.3 | -27.5 | – |

| 20:30 | USD – PPI (MoM) (May) | 0.5% | 0.8% | – |

Technical Analysis

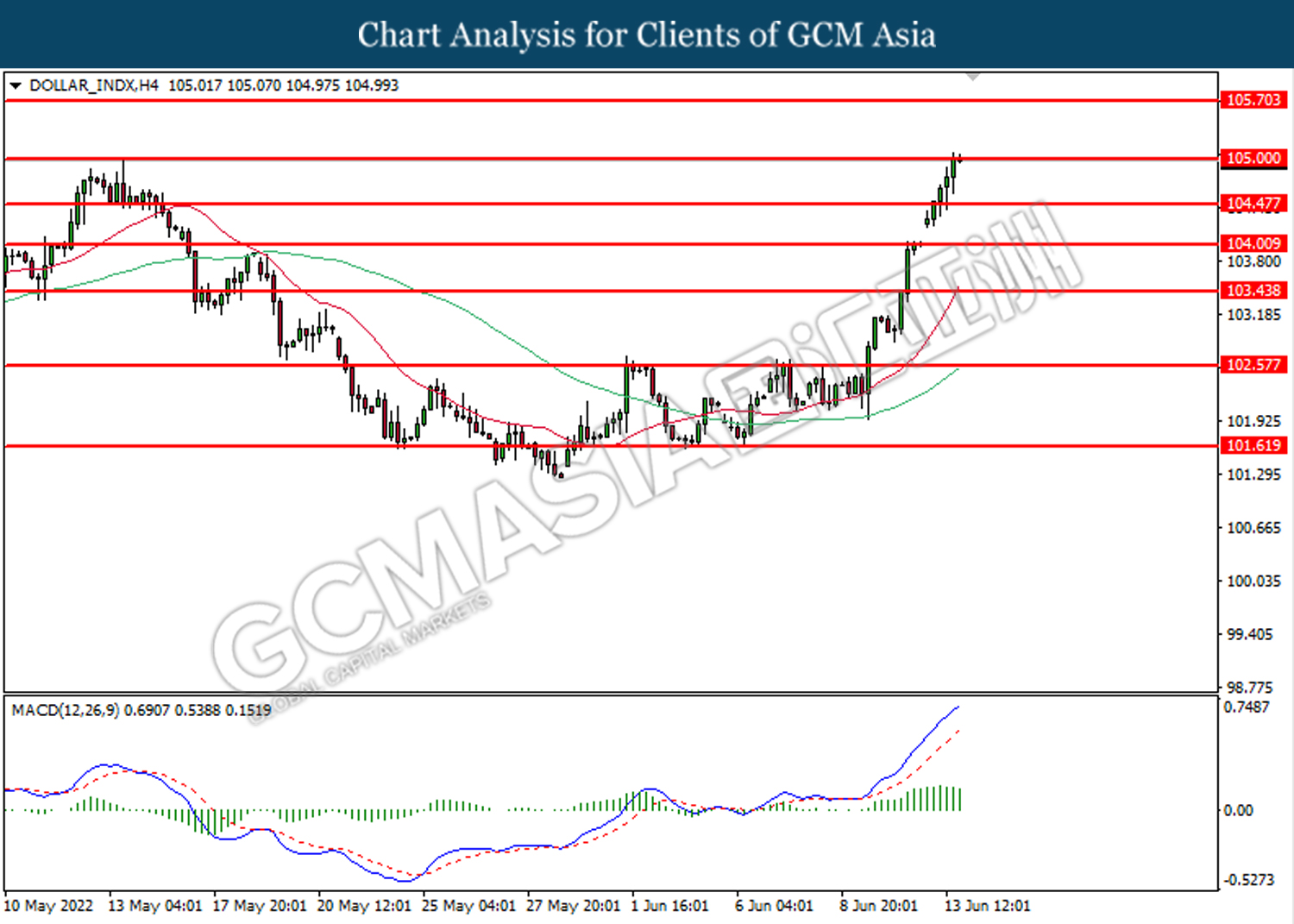

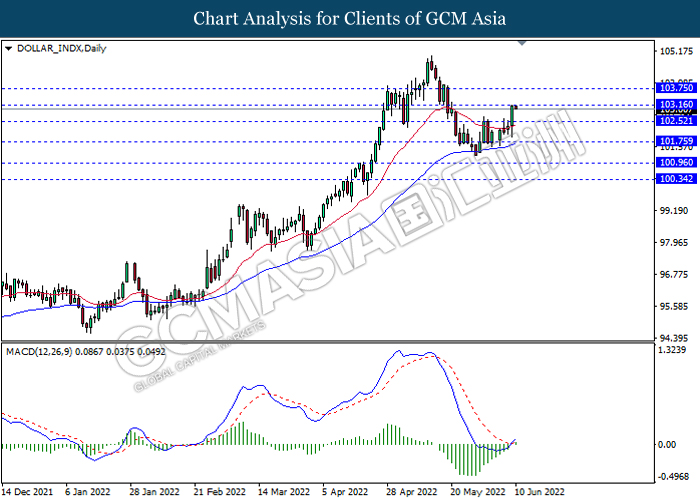

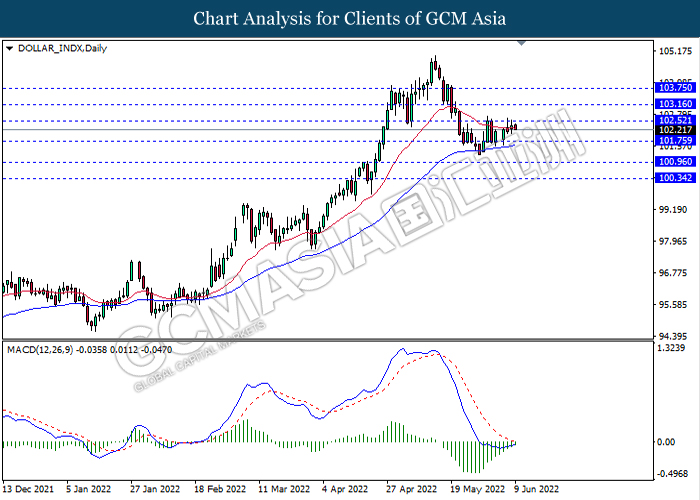

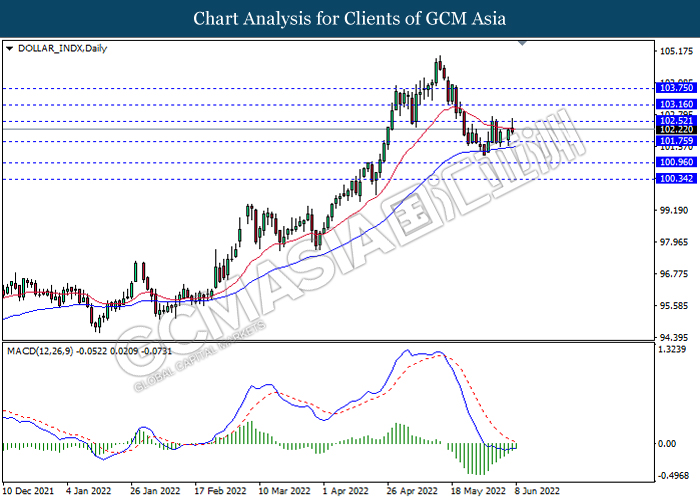

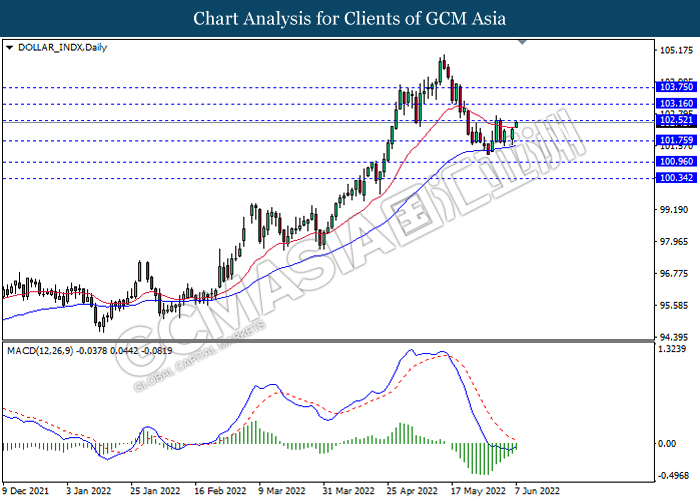

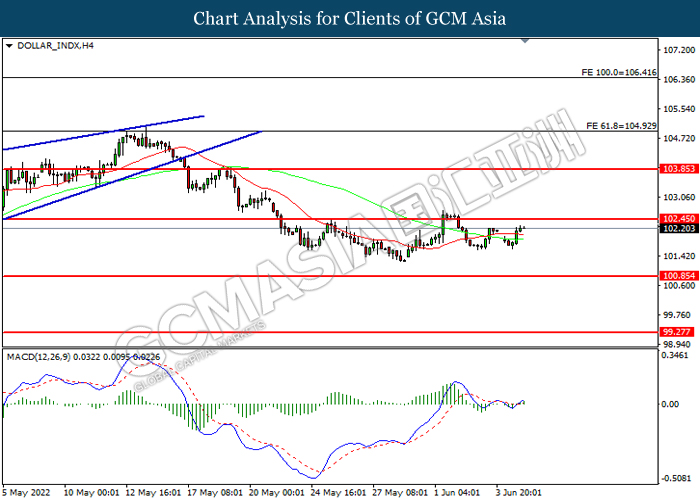

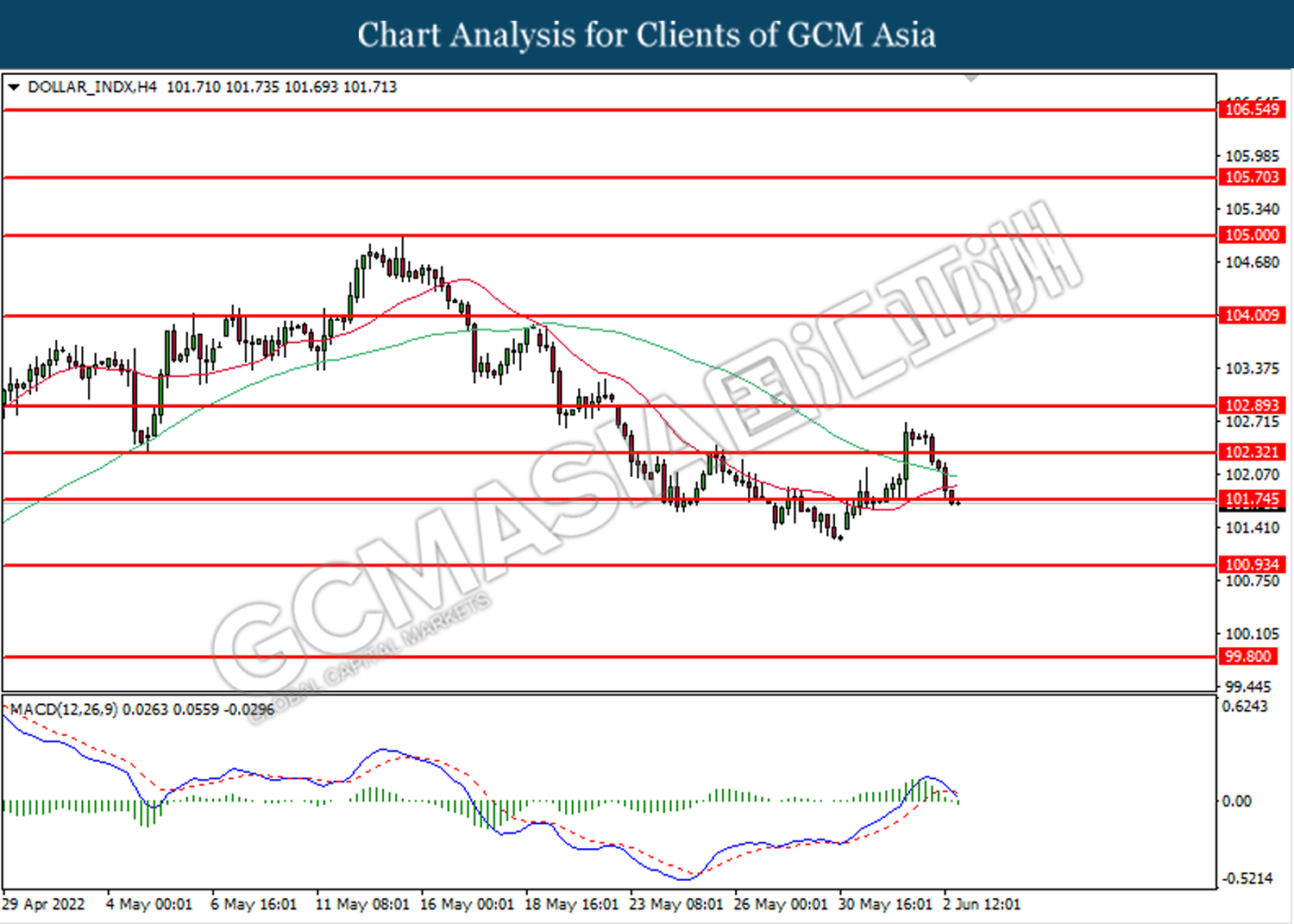

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 105.00. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 105.00, 105.70

Support level: 104.45, 104.00

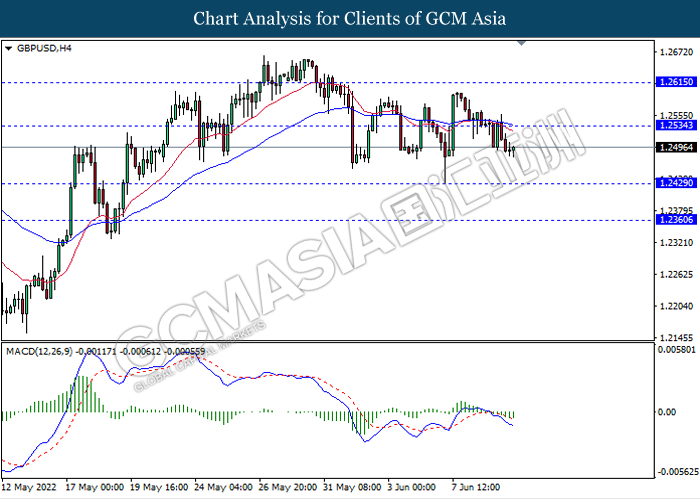

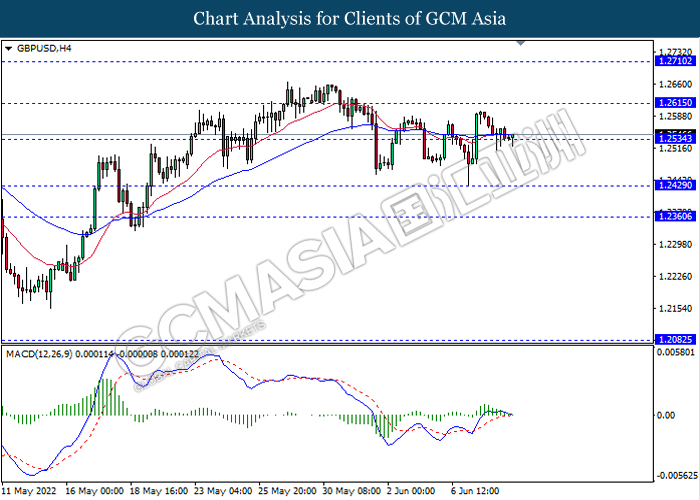

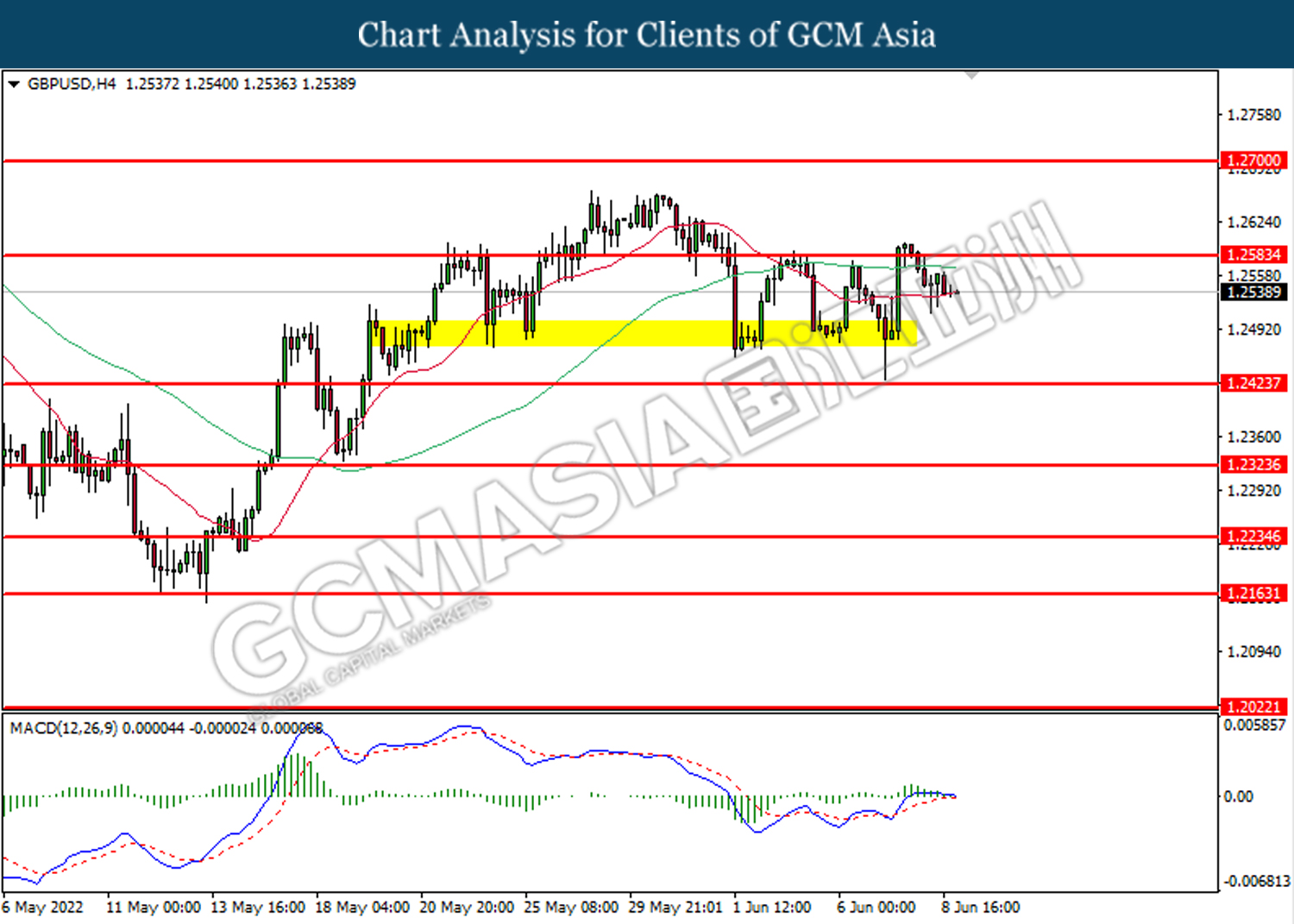

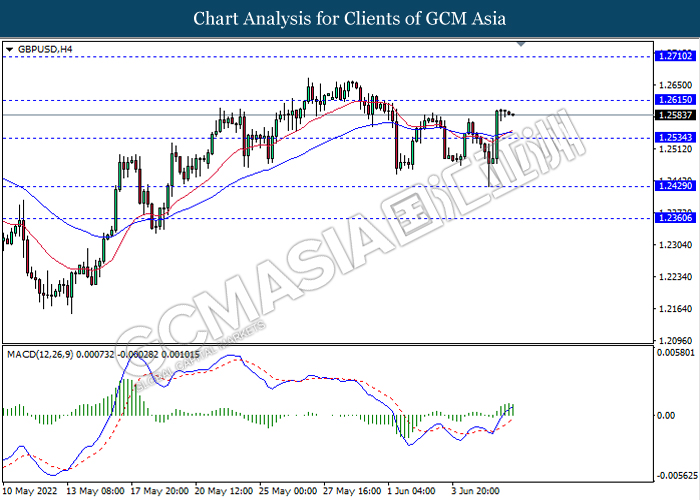

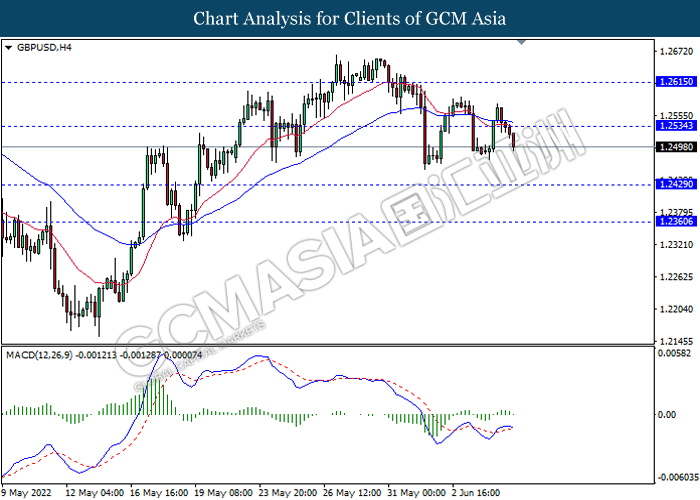

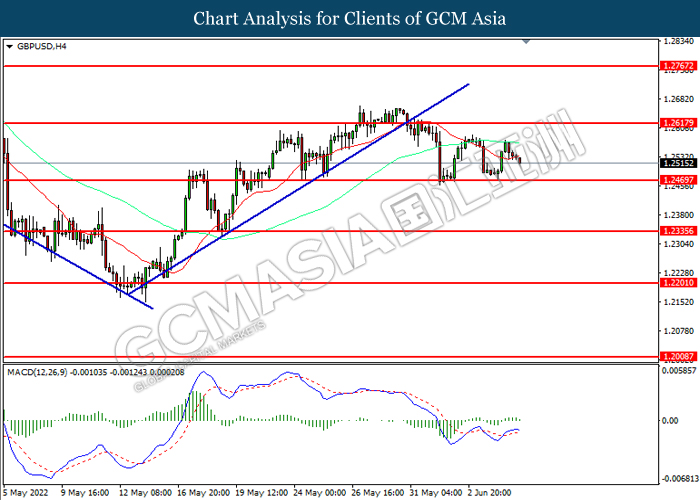

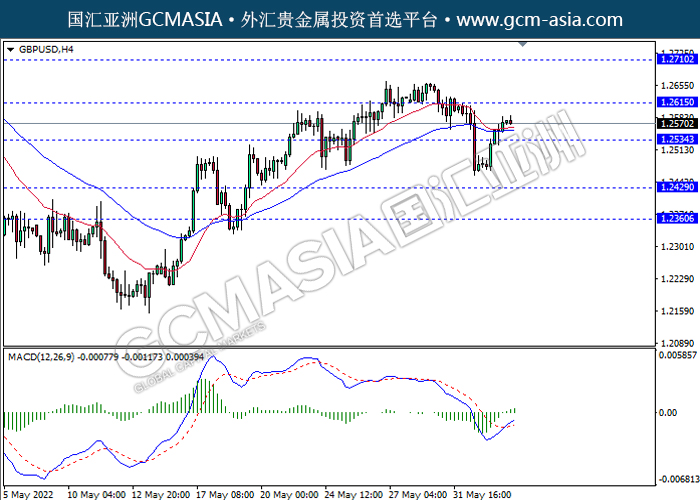

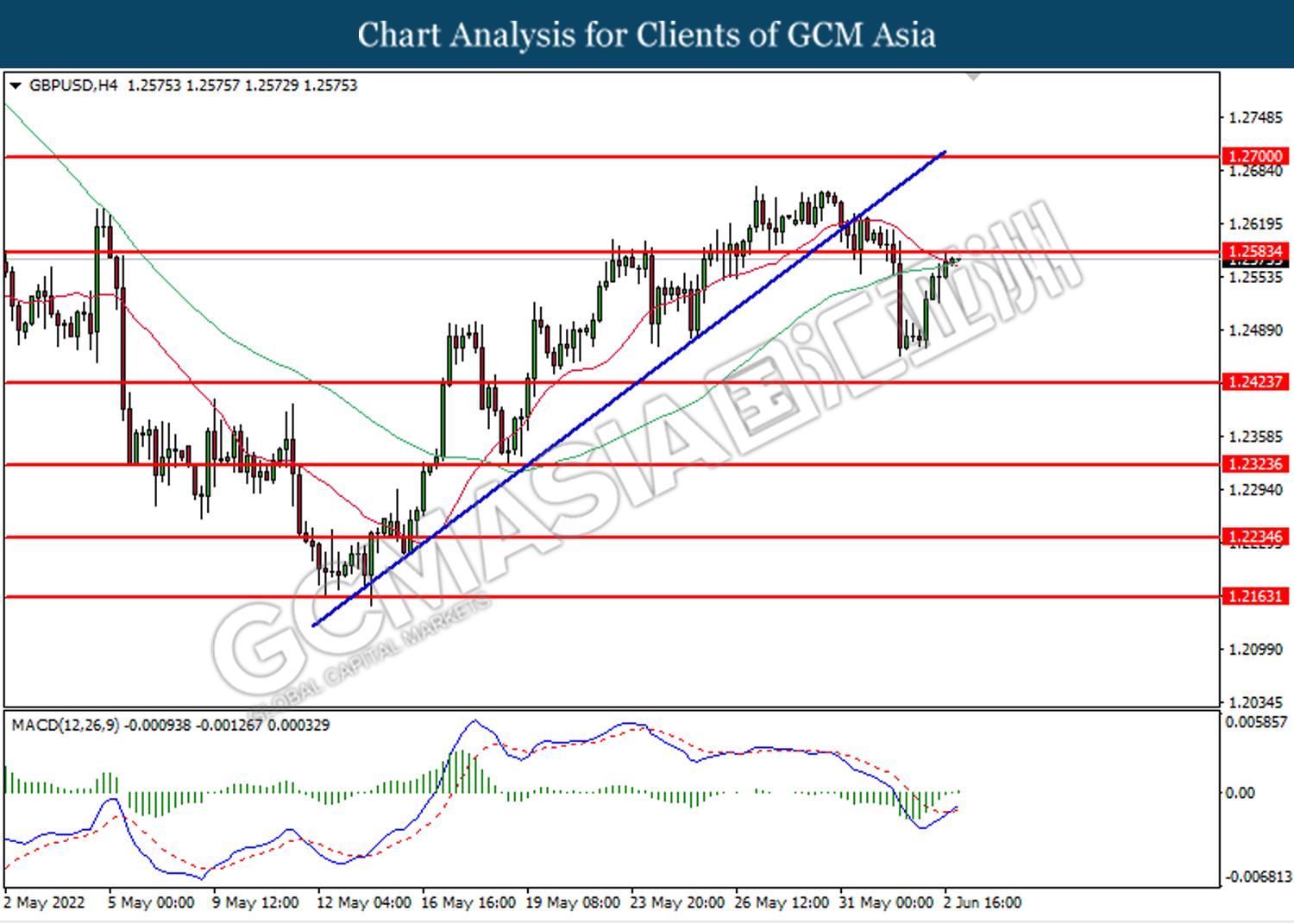

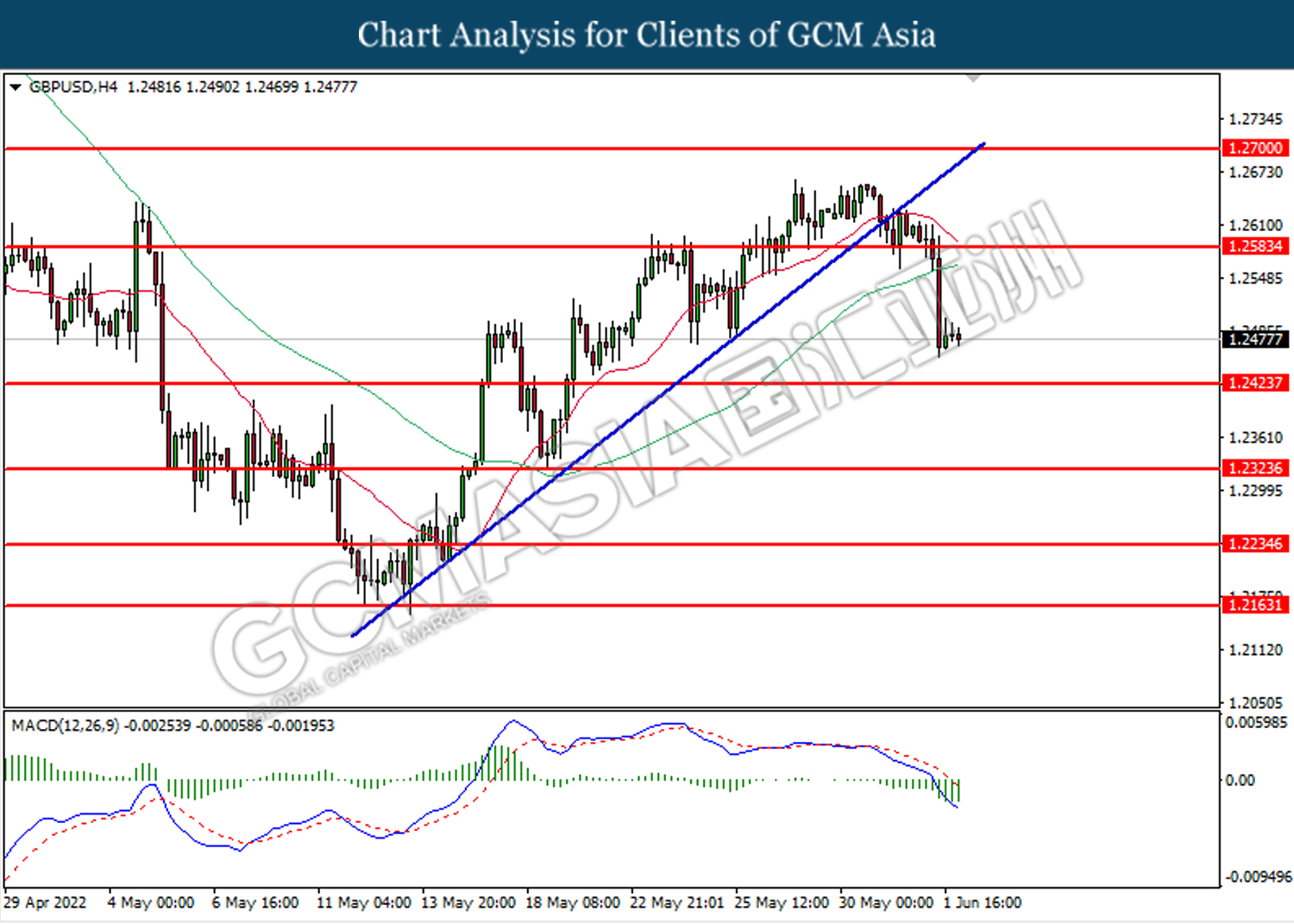

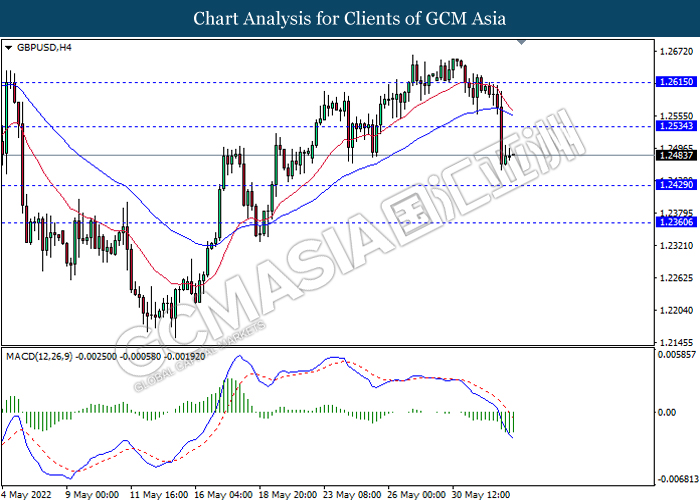

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2165. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2085.

Resistance level: 1.2165, 1.2235

Support level: 1.2085, 1.2020

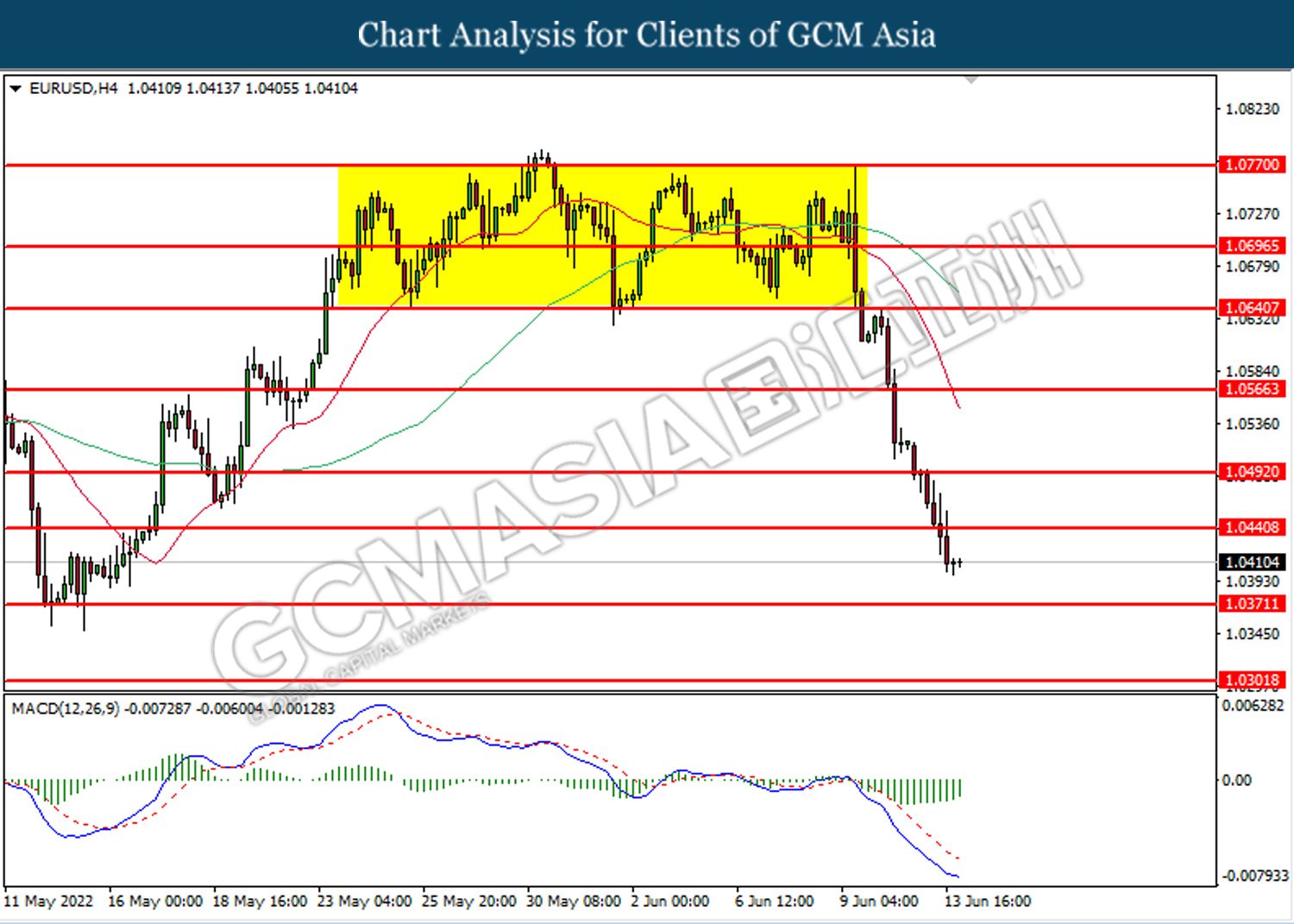

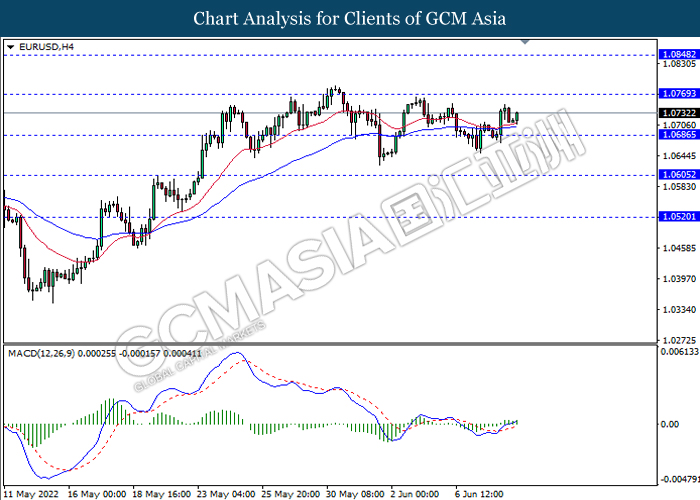

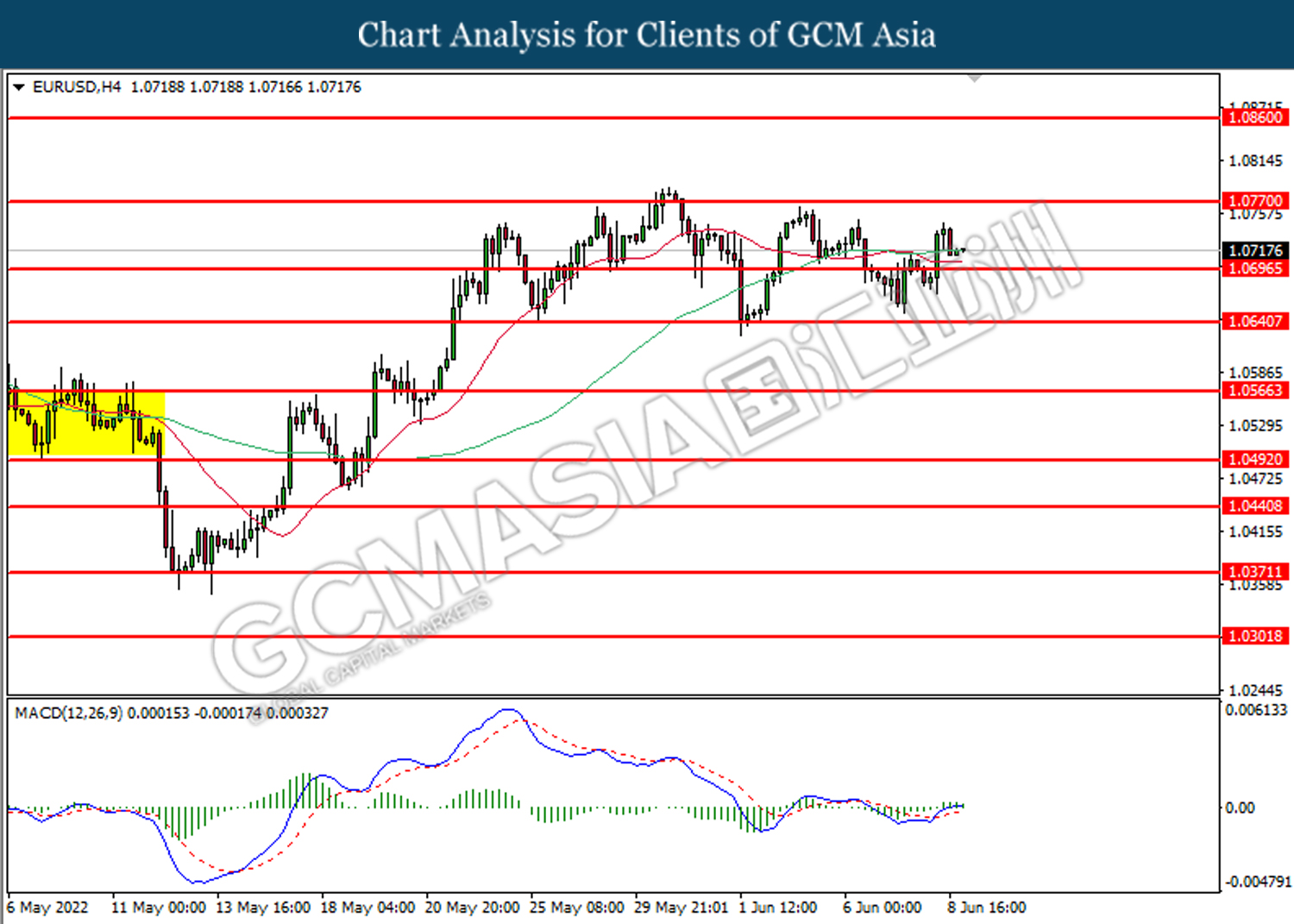

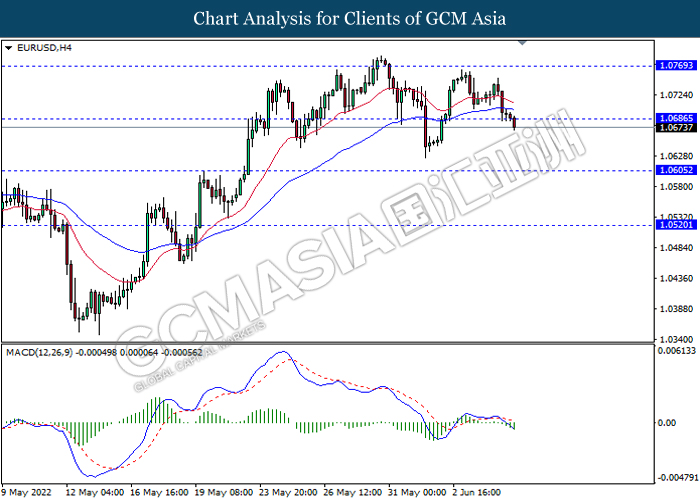

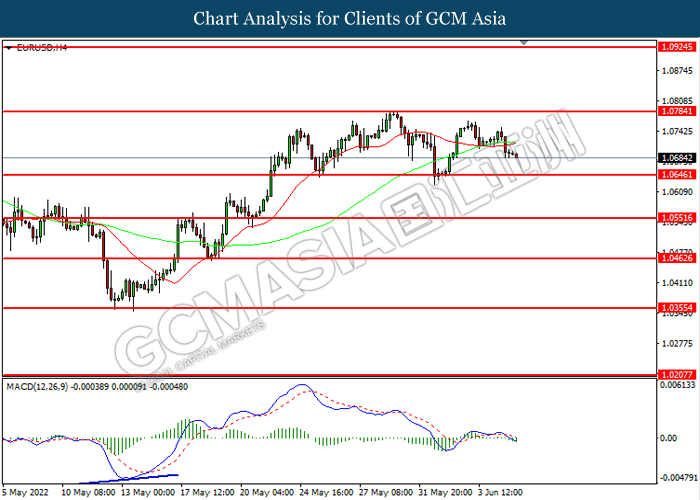

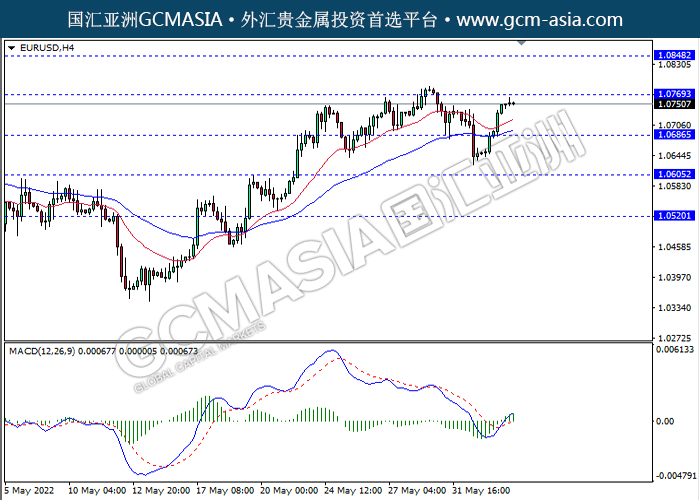

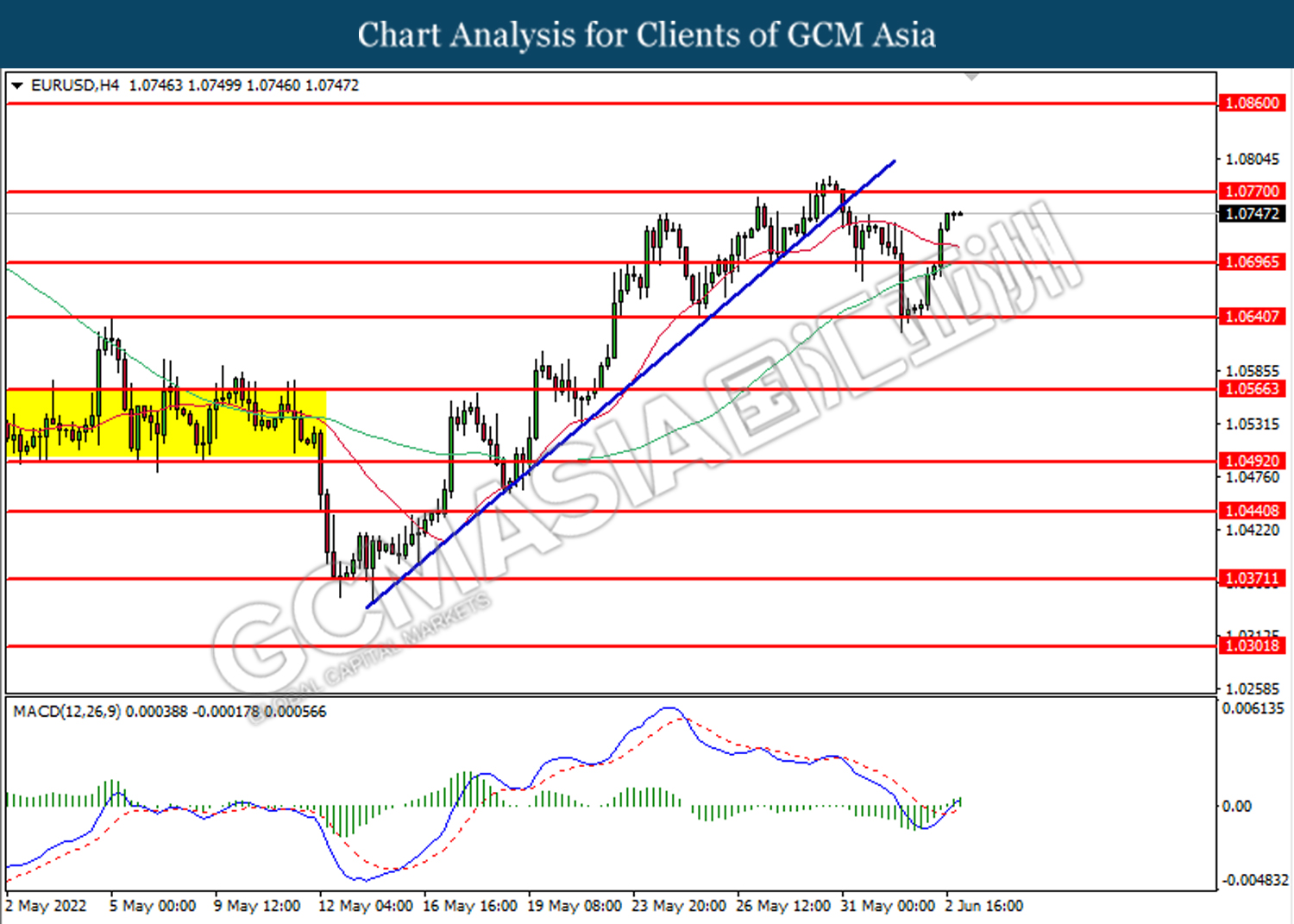

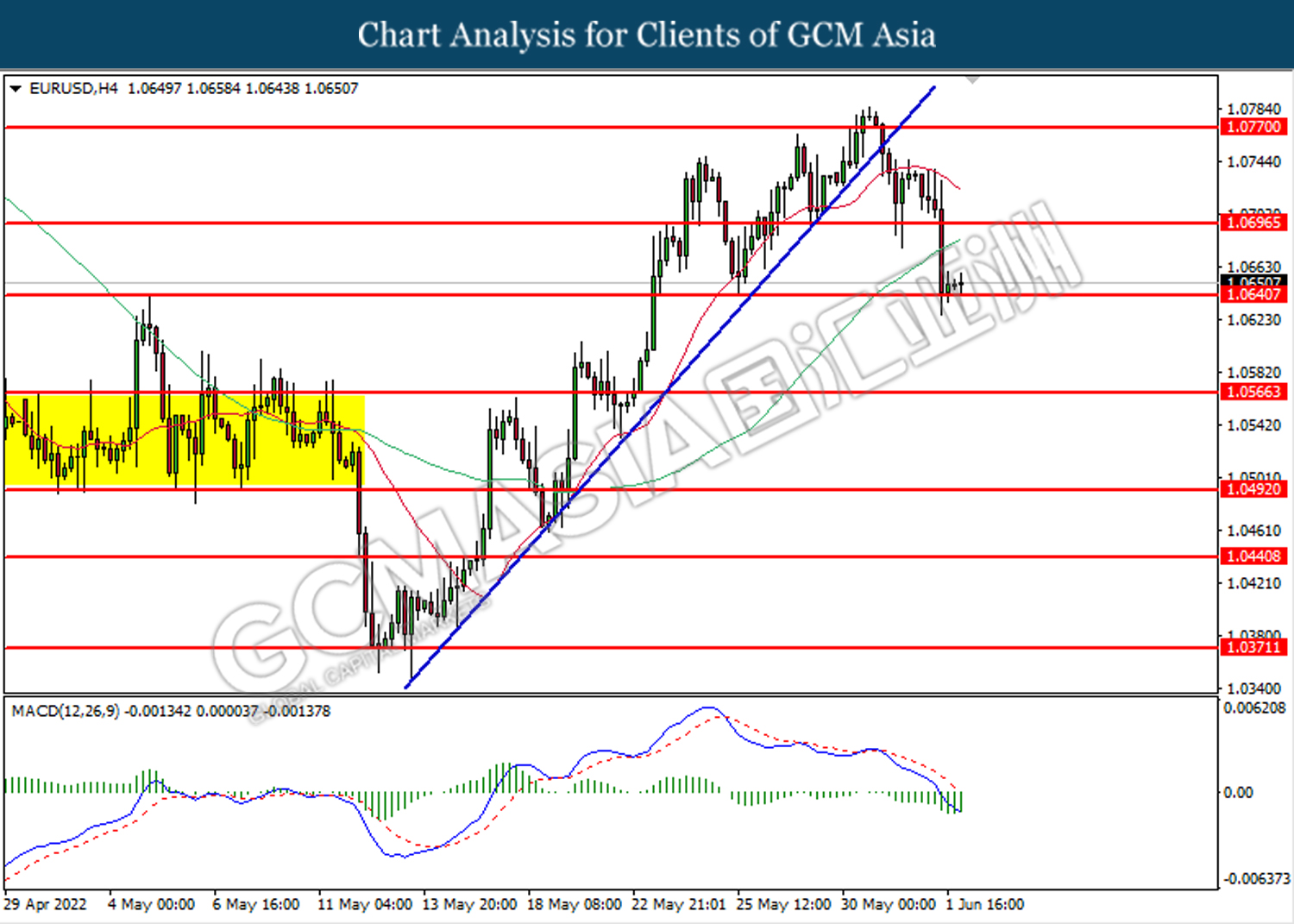

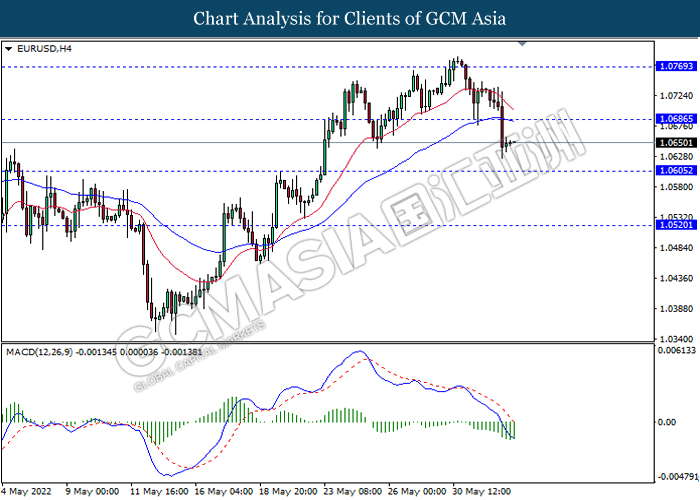

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.0440. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0370.

Resistance level: 1.0440, 1.0490

Support level: 1.0370, 1.0300

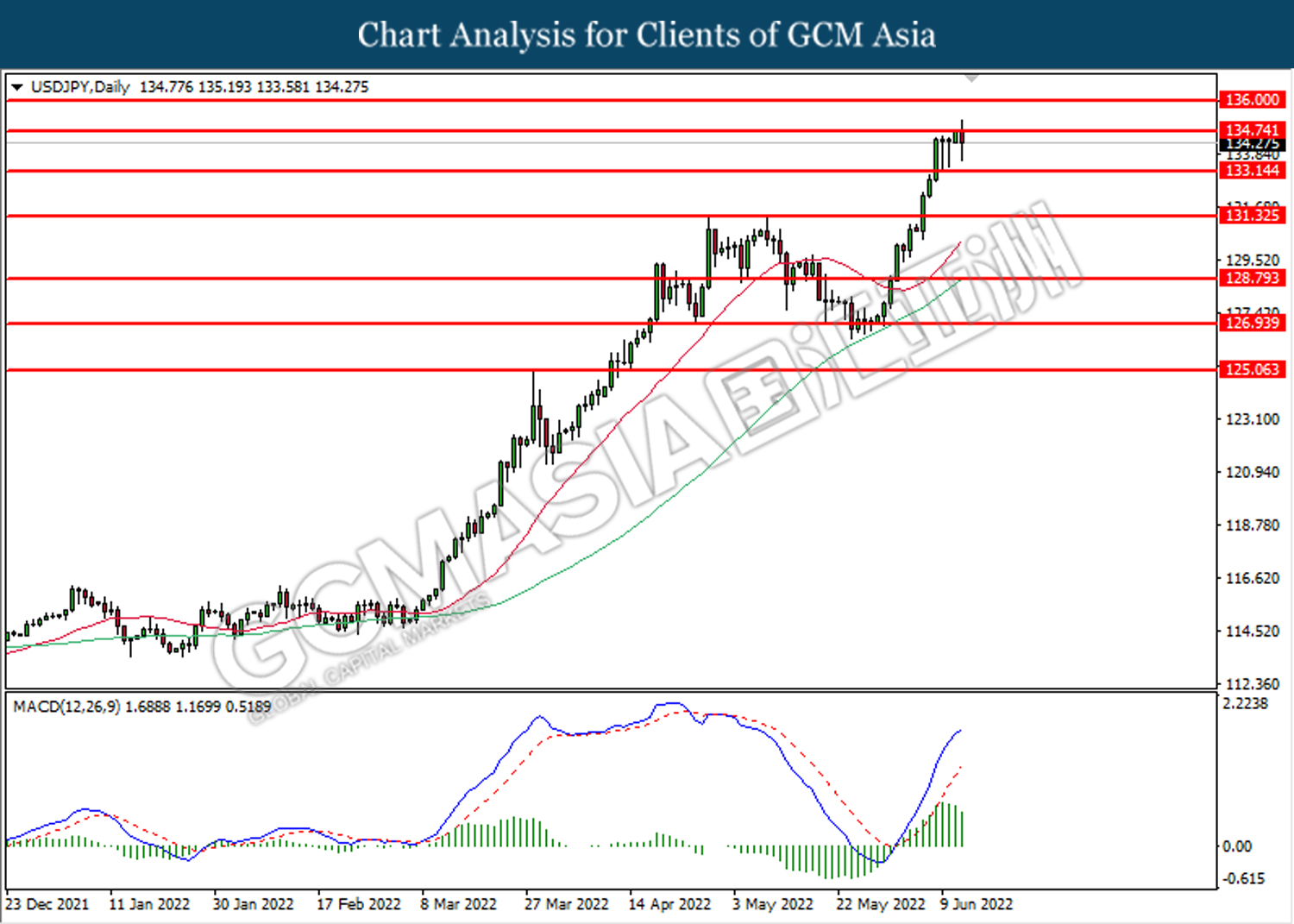

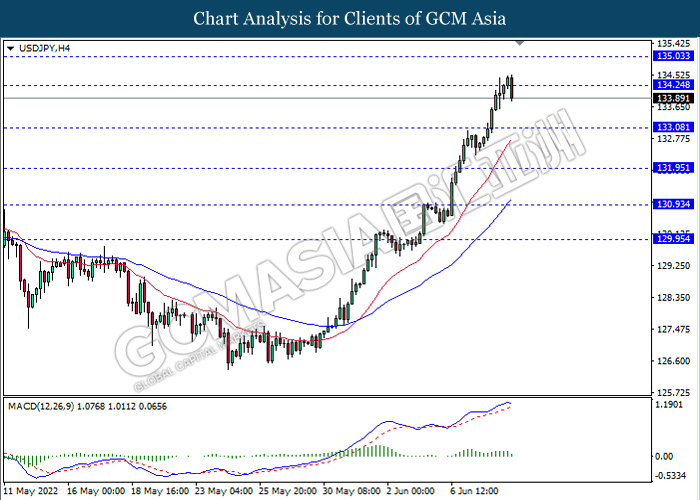

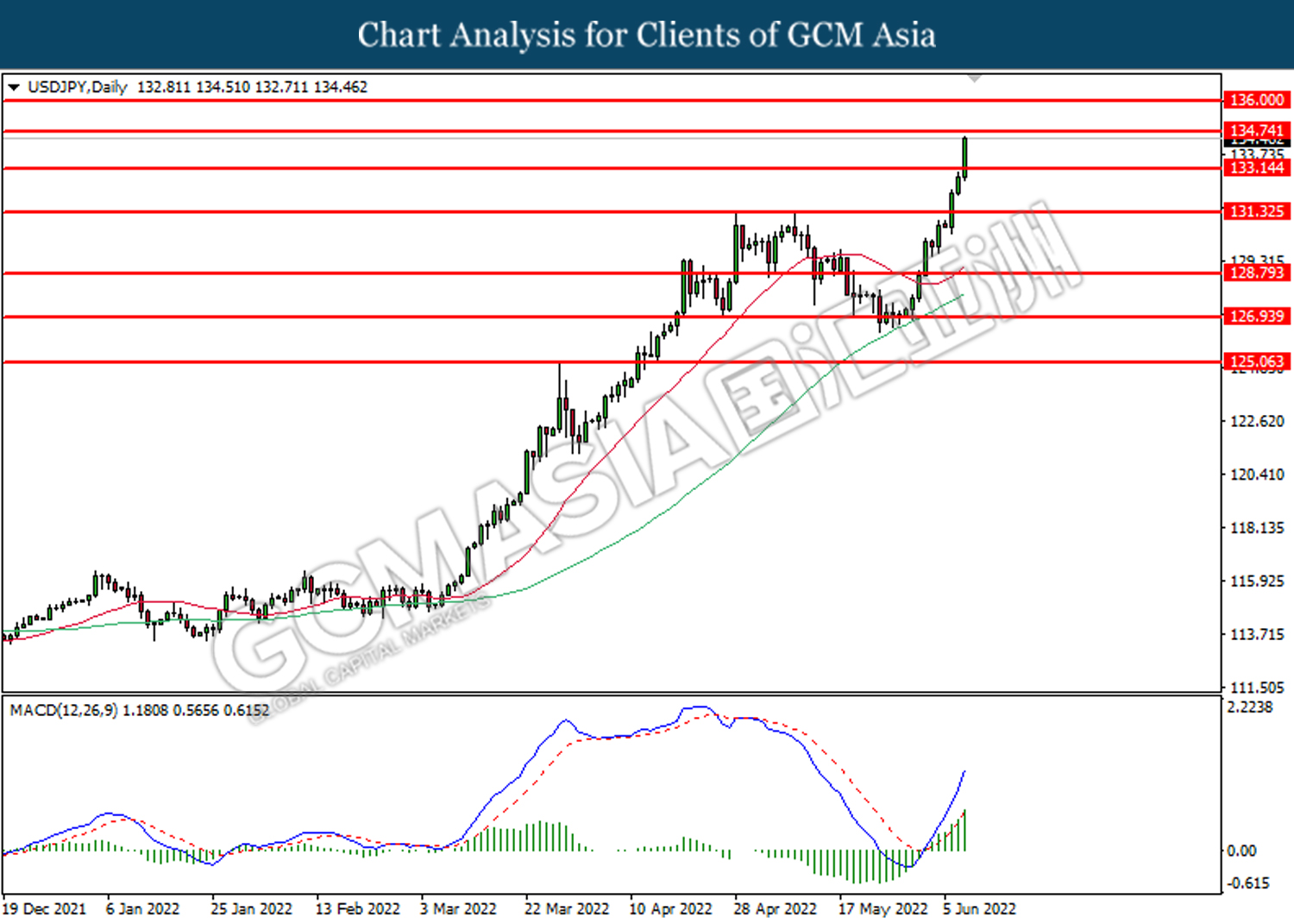

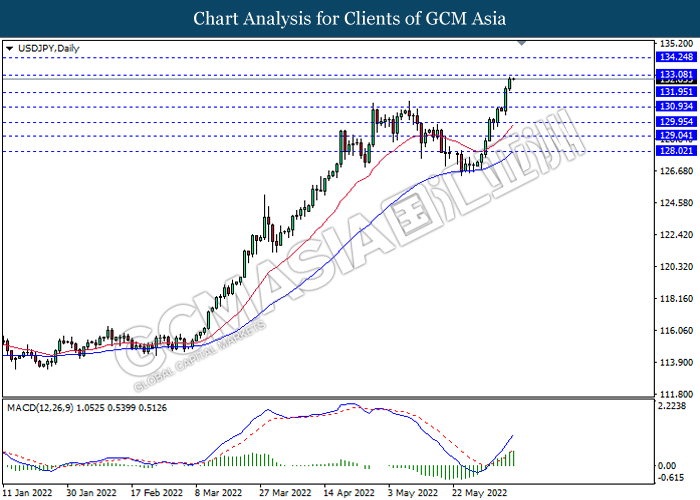

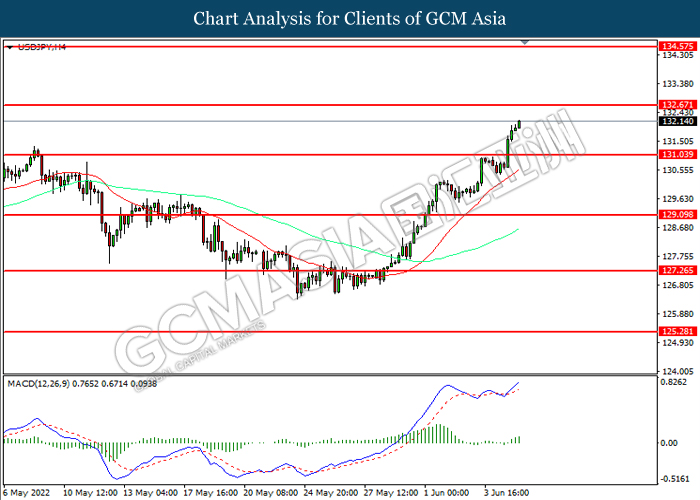

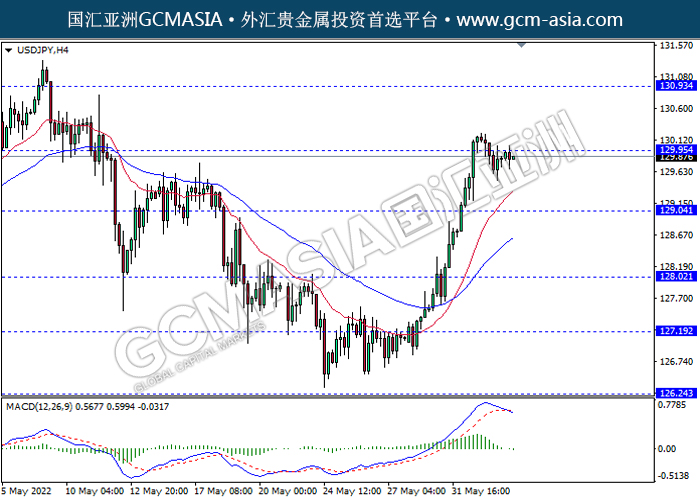

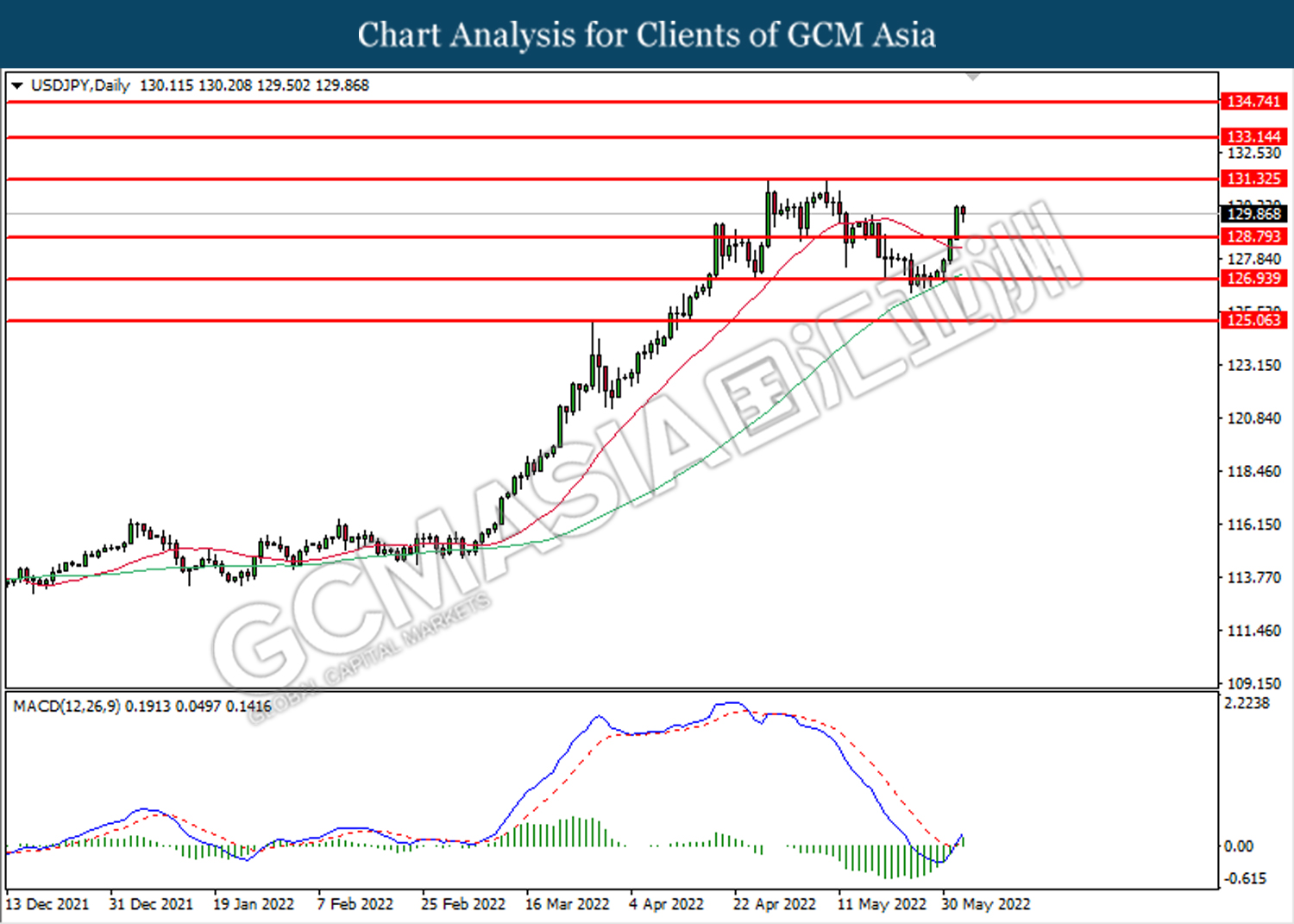

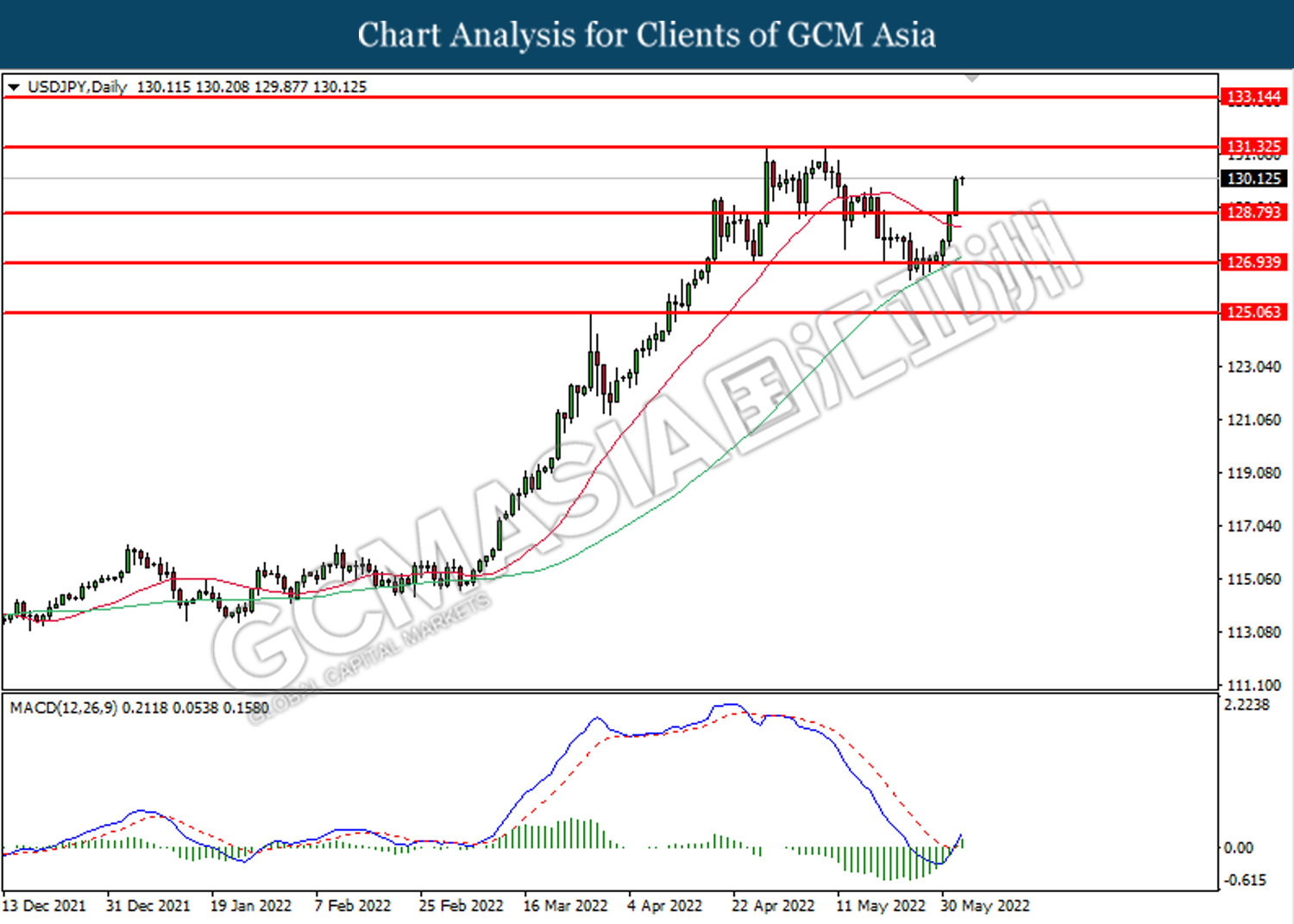

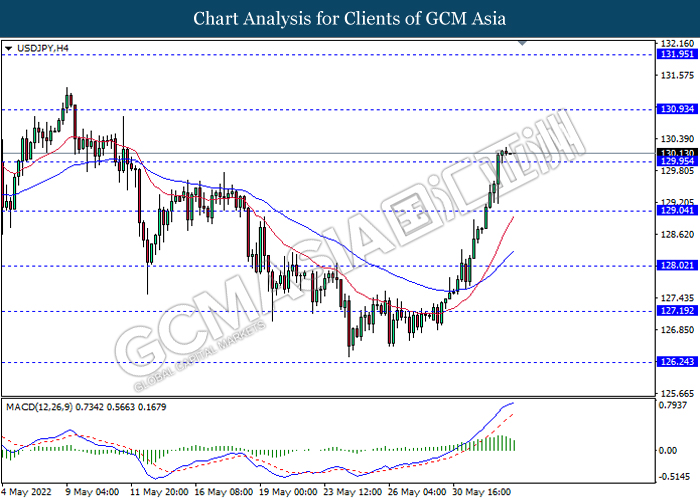

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.75. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

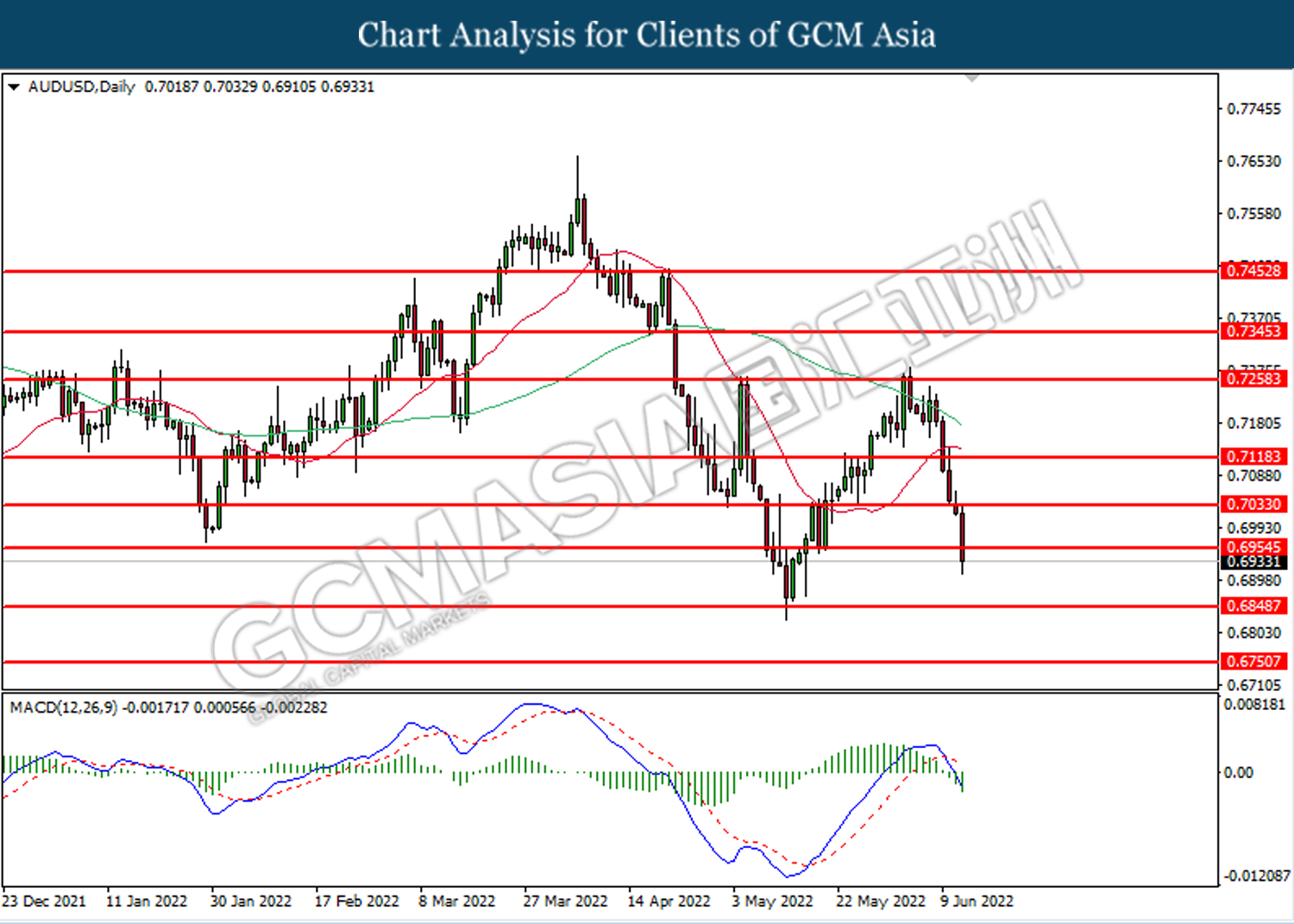

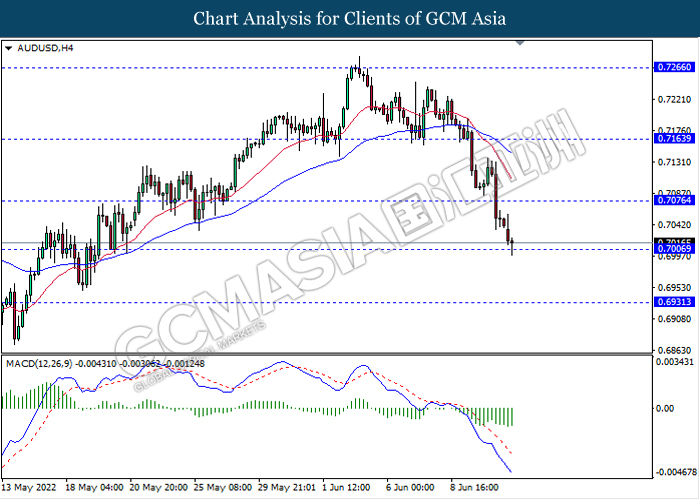

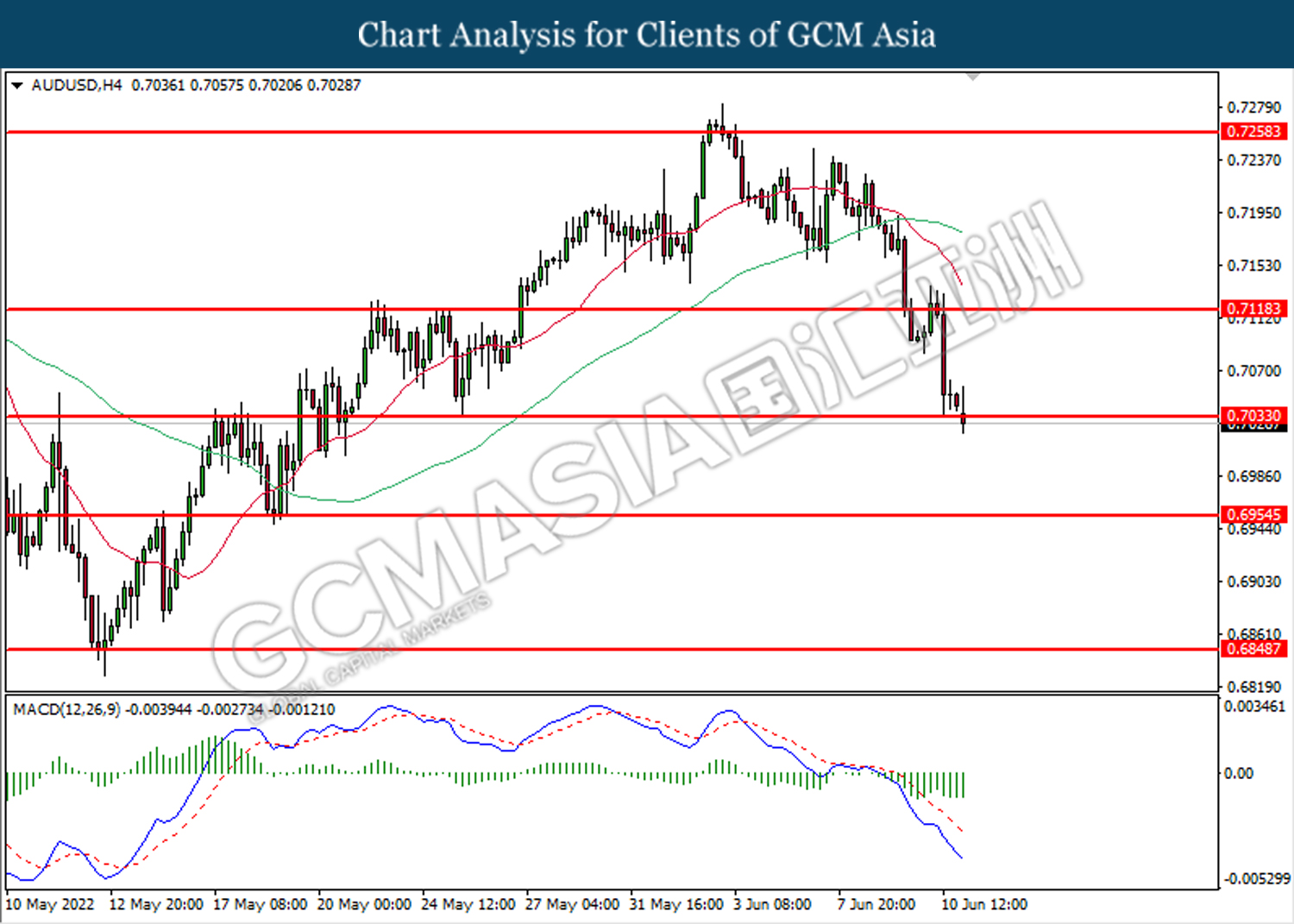

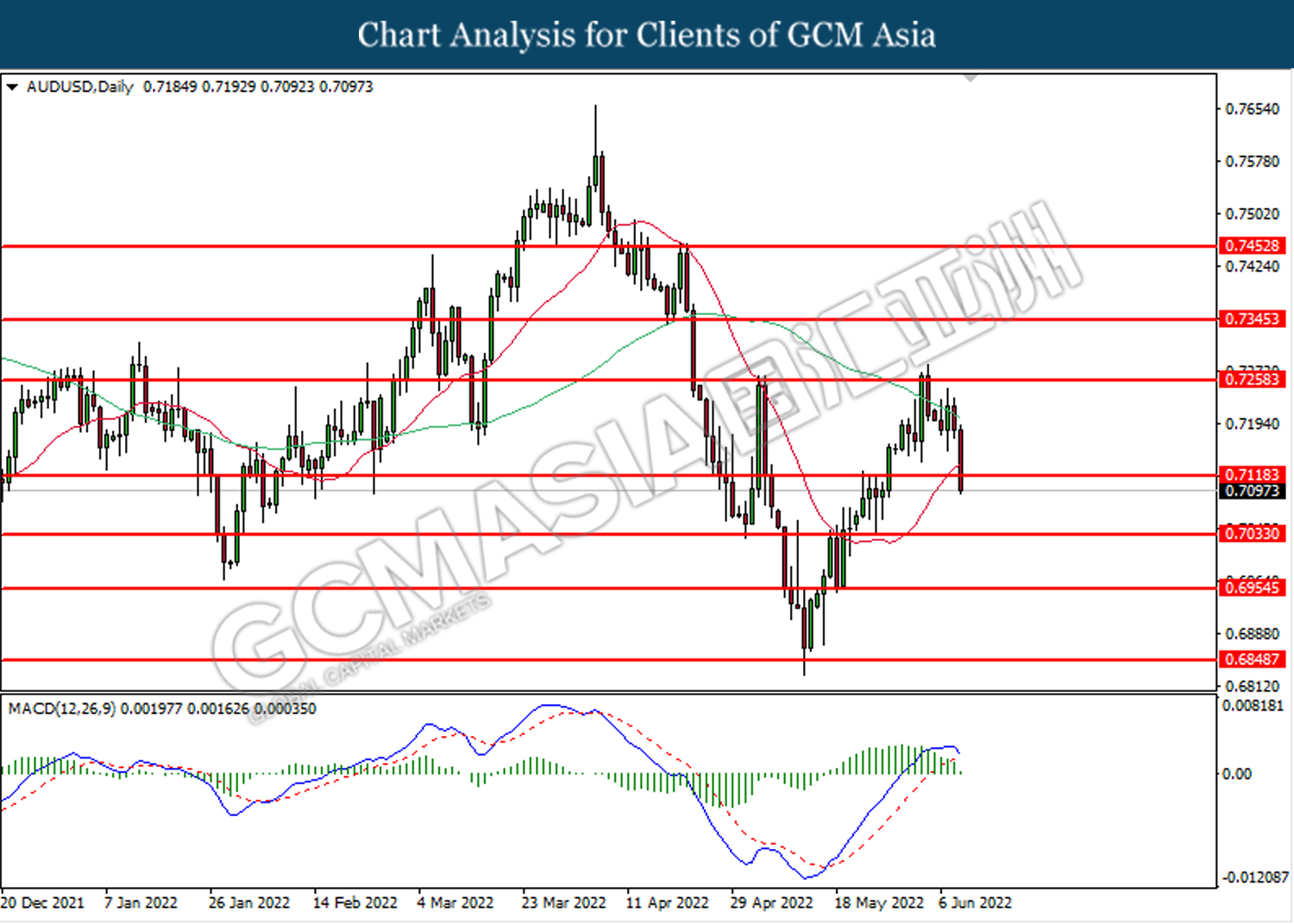

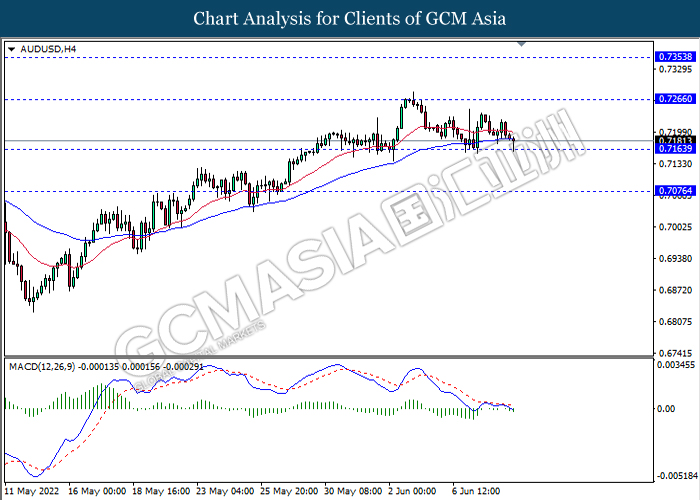

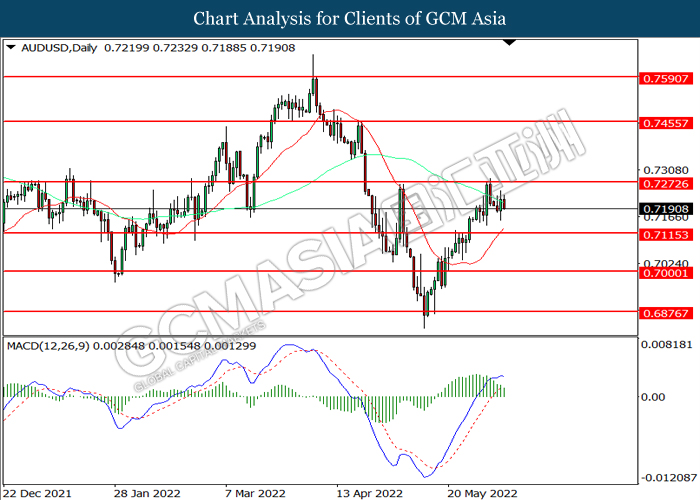

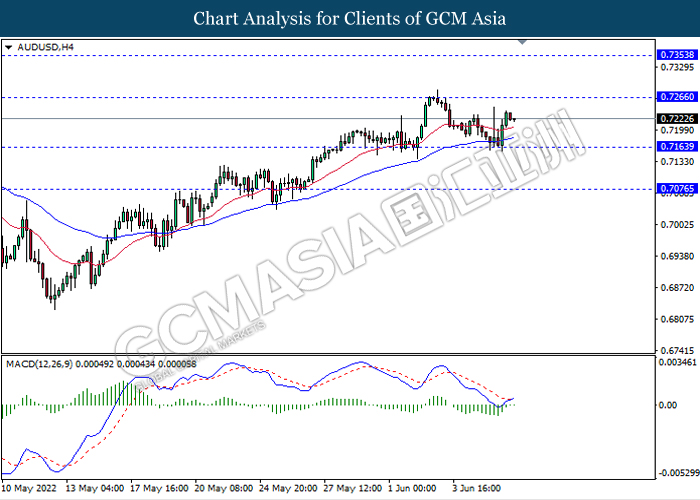

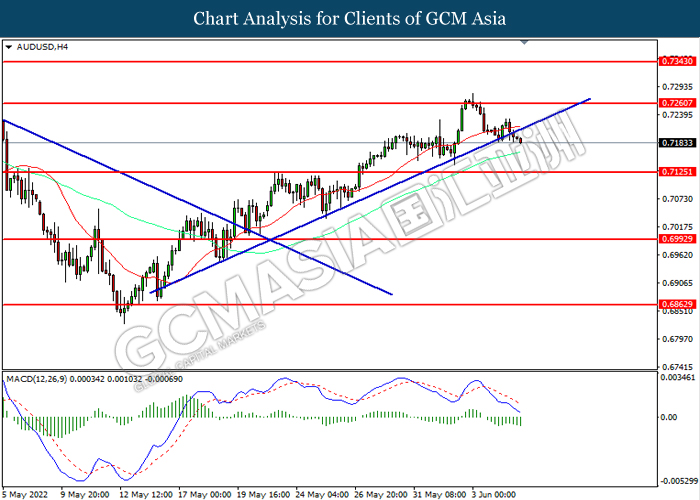

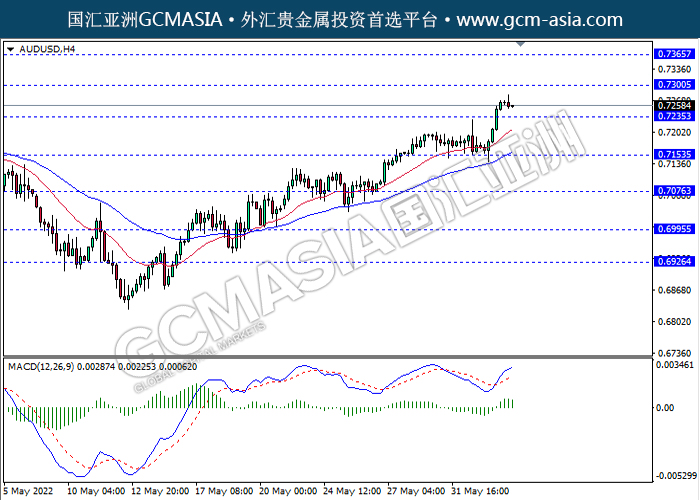

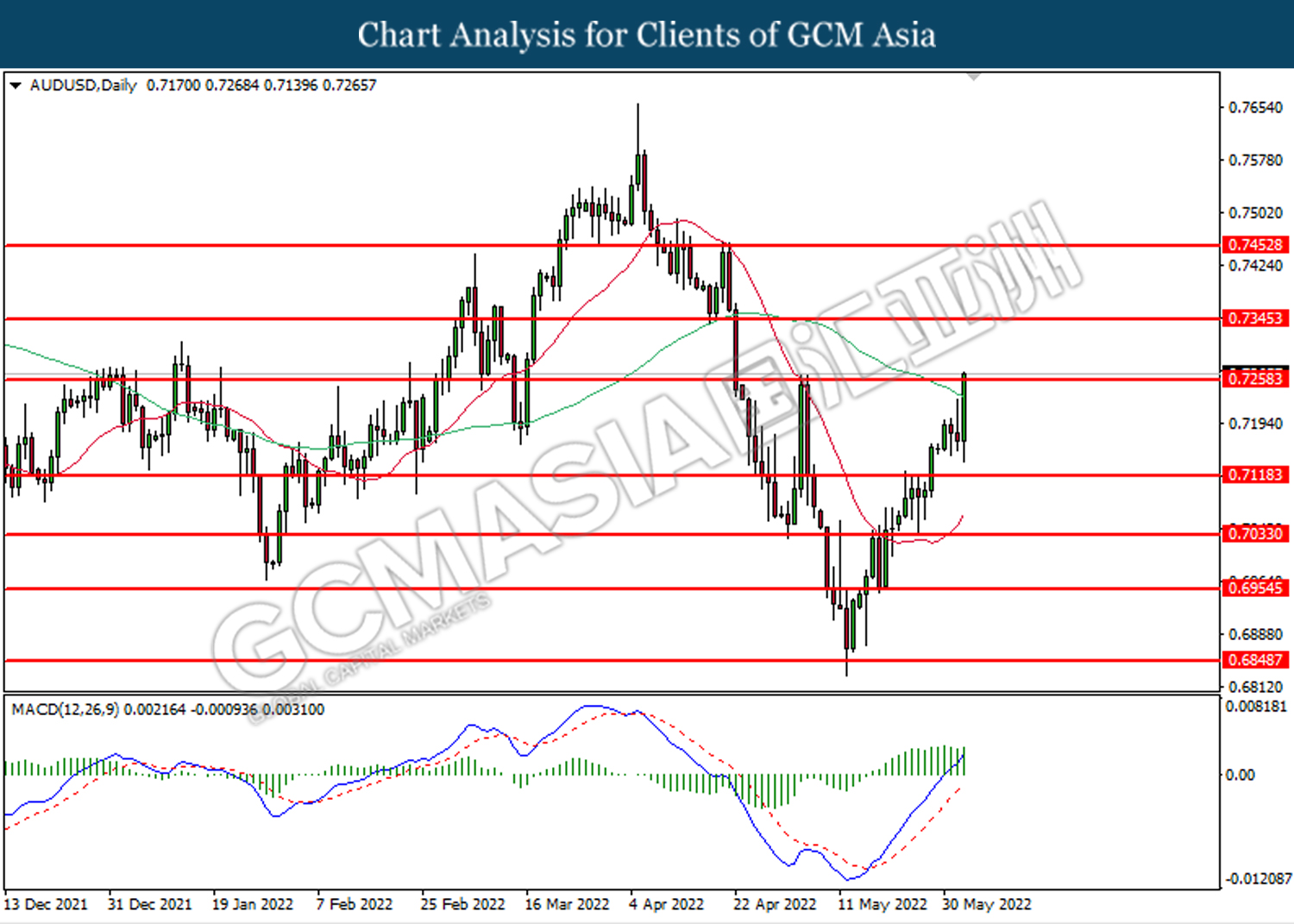

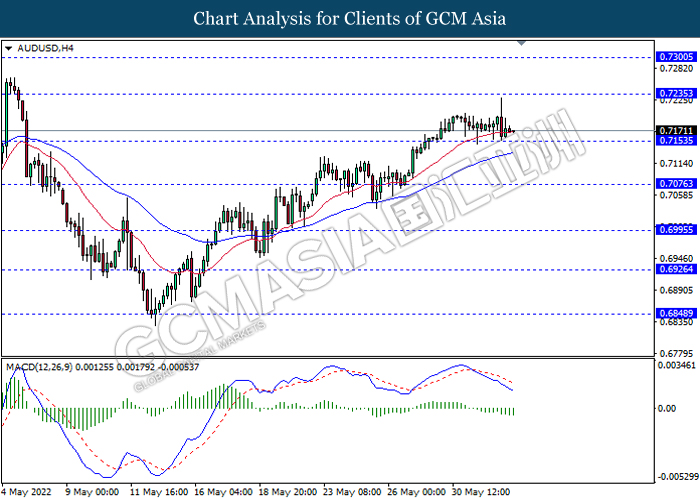

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6955. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.7035, 0.7120

Support level: 0.6850, 0.6750

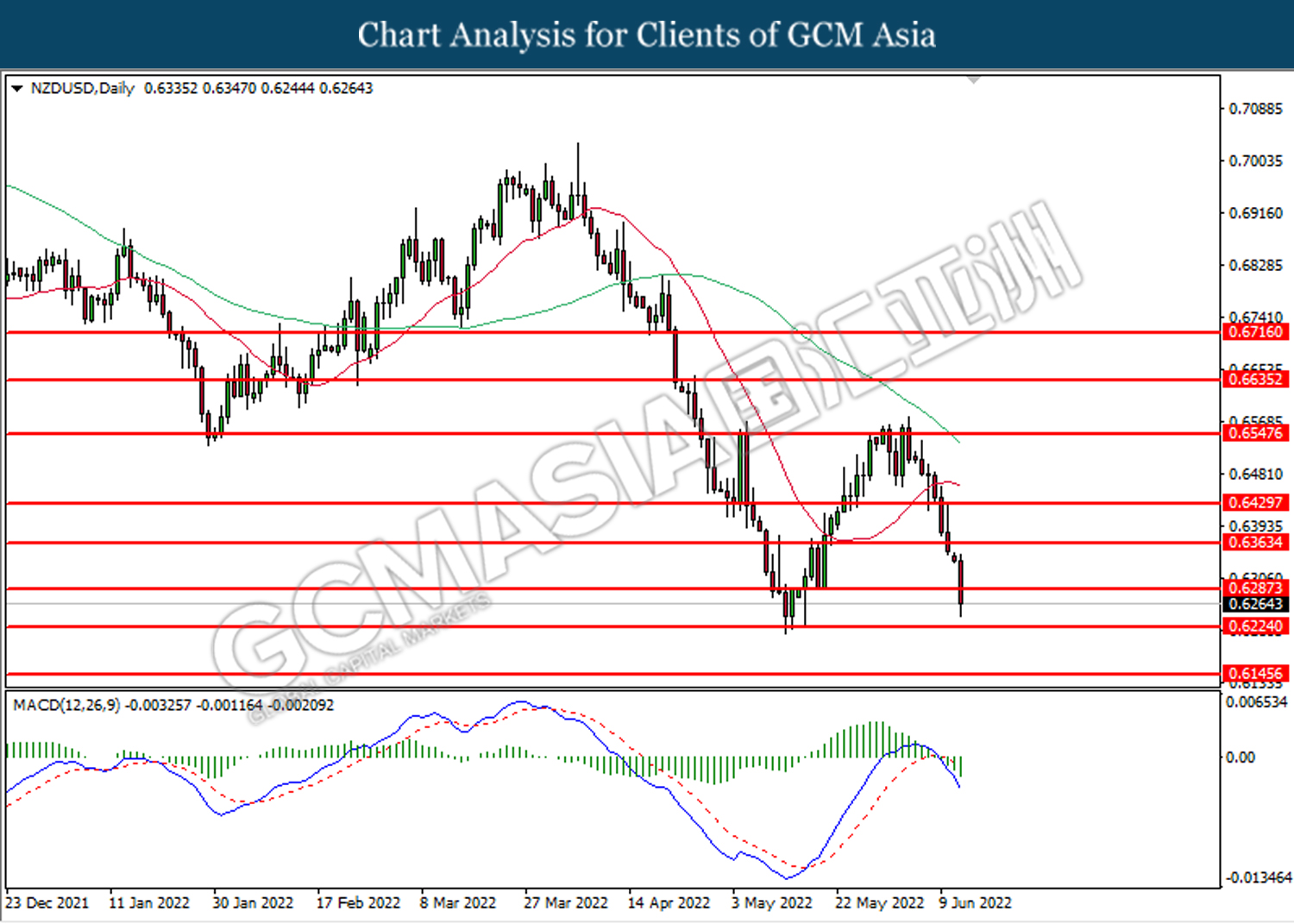

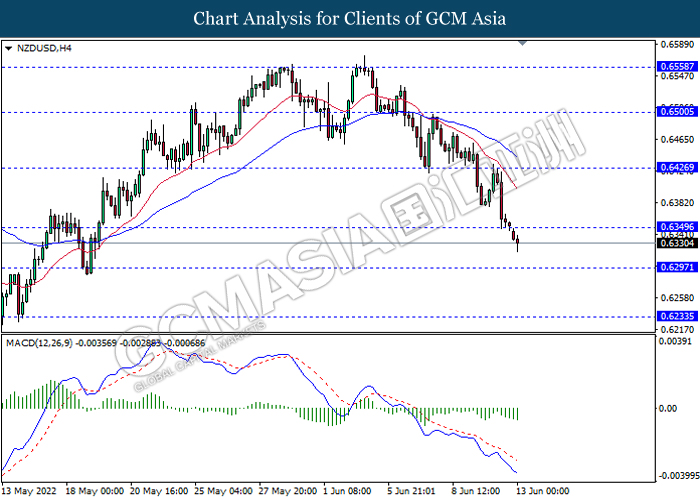

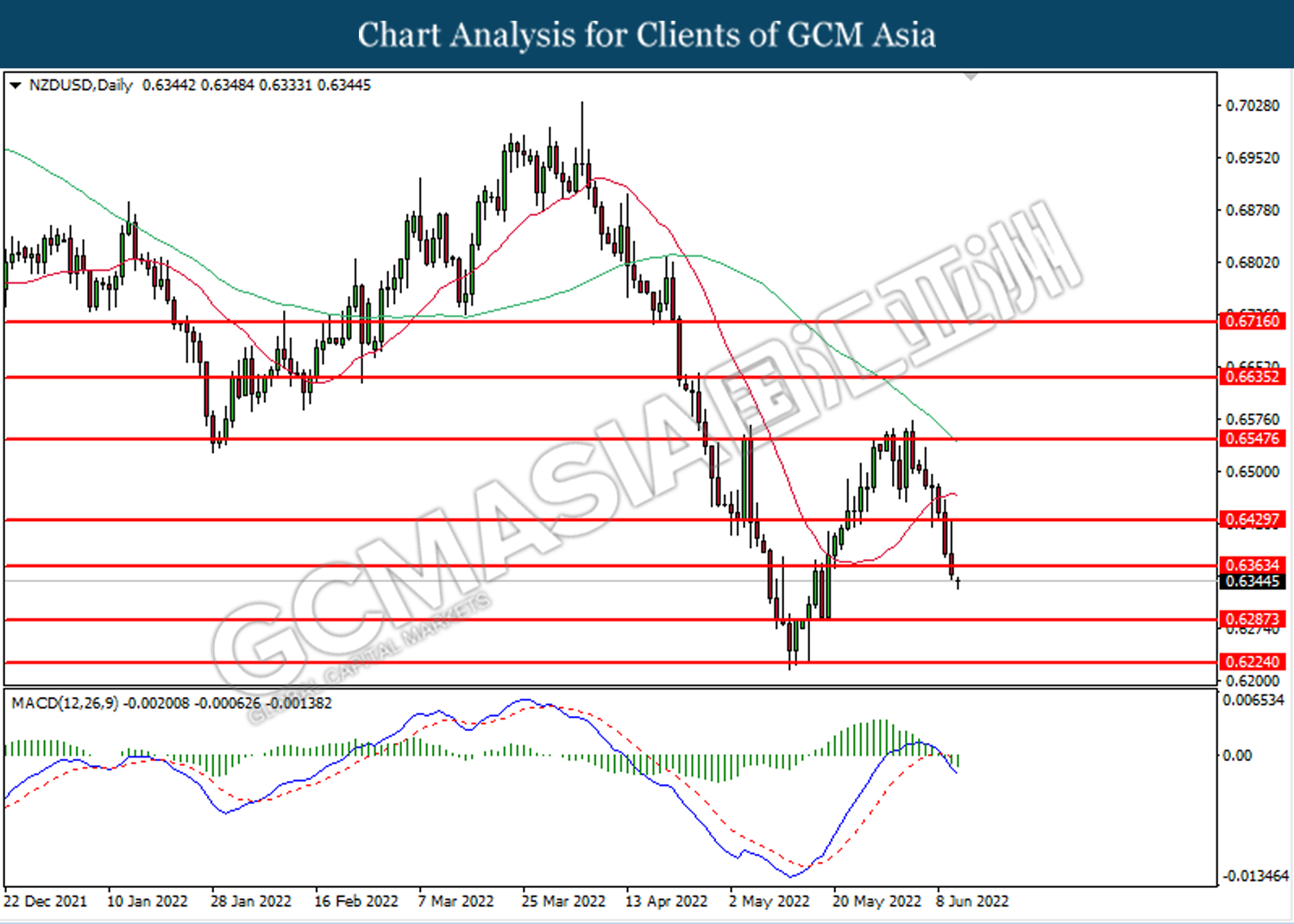

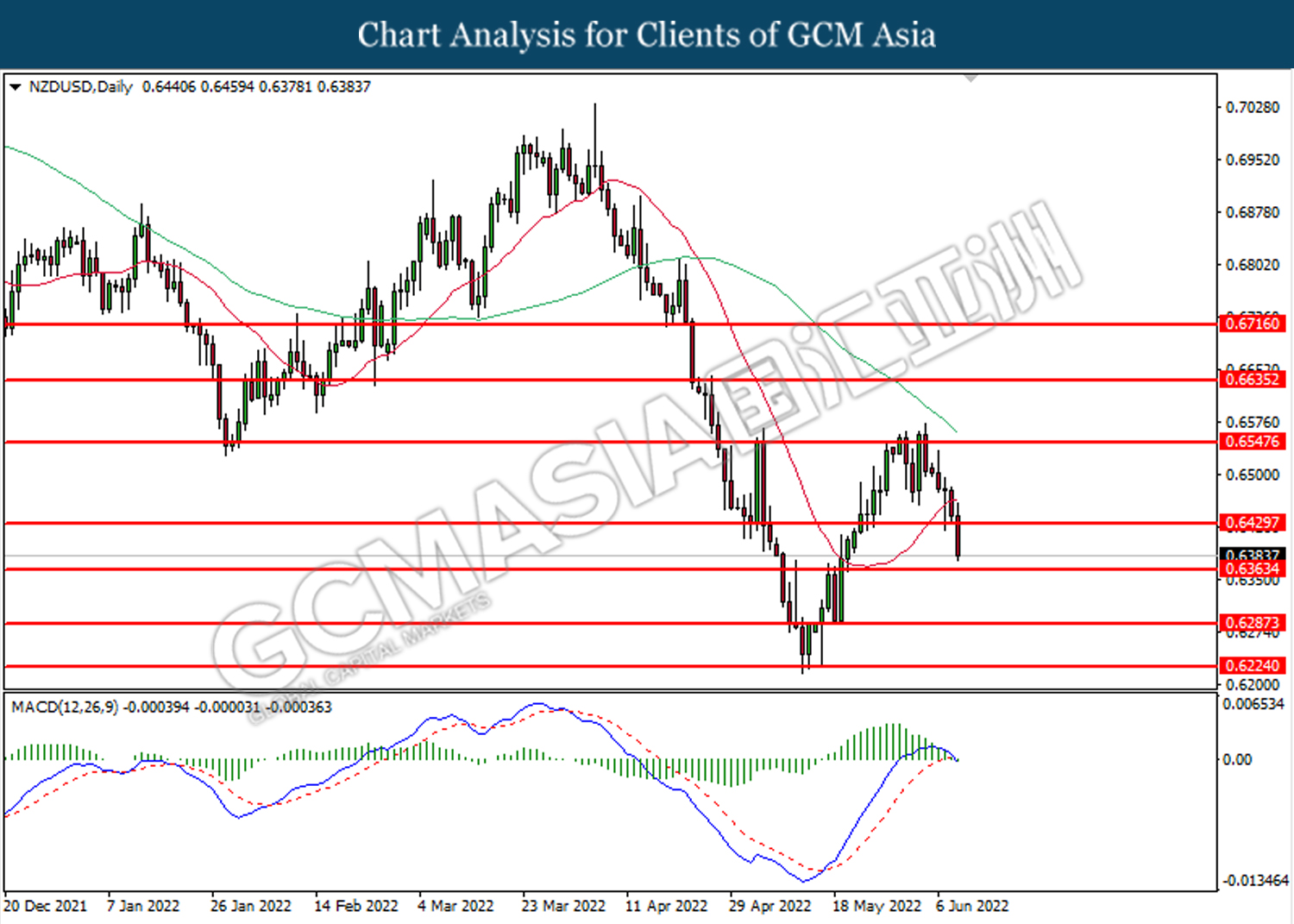

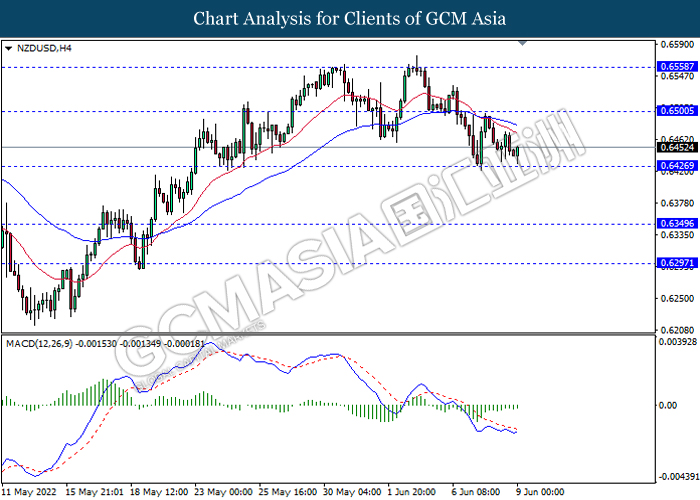

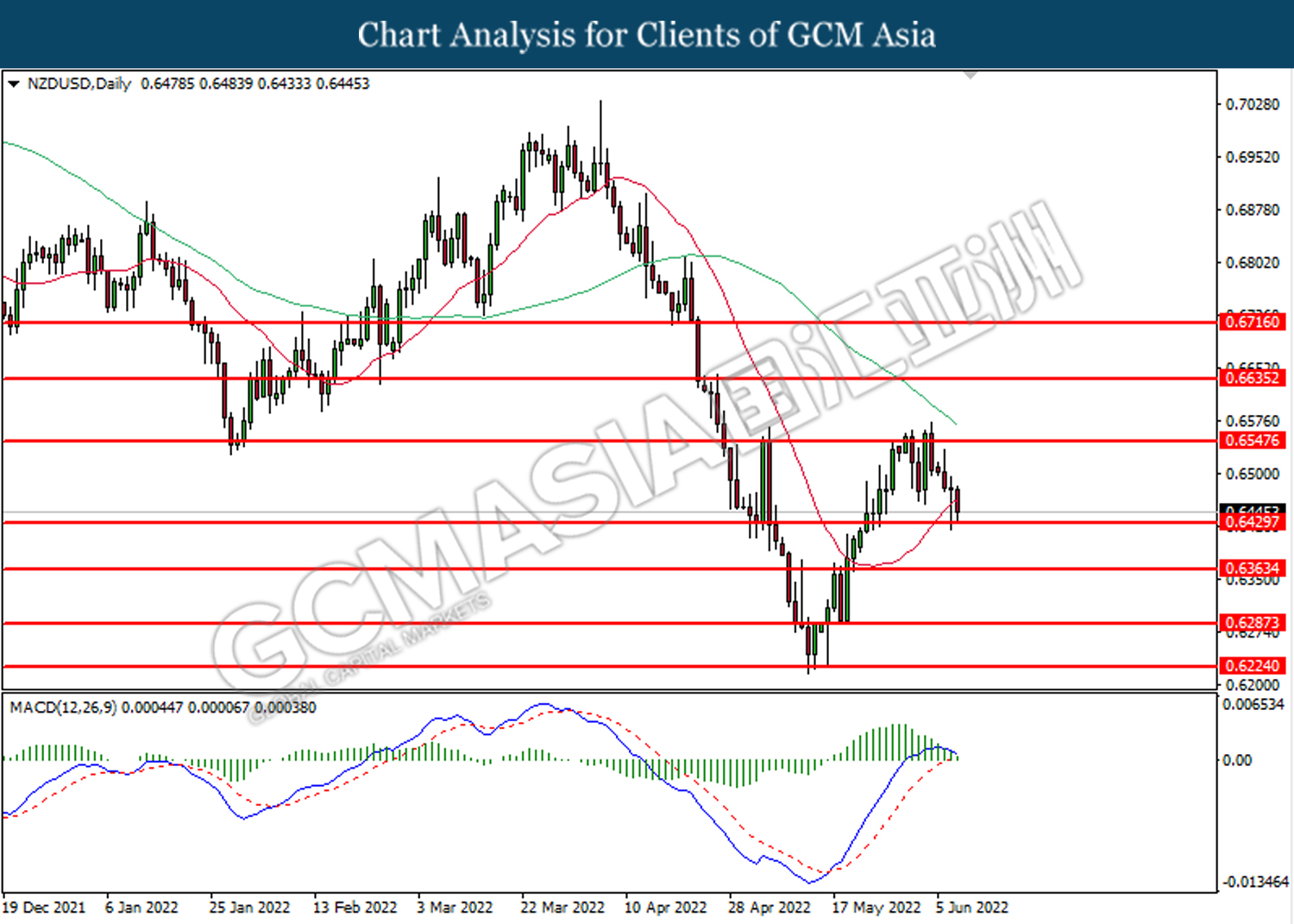

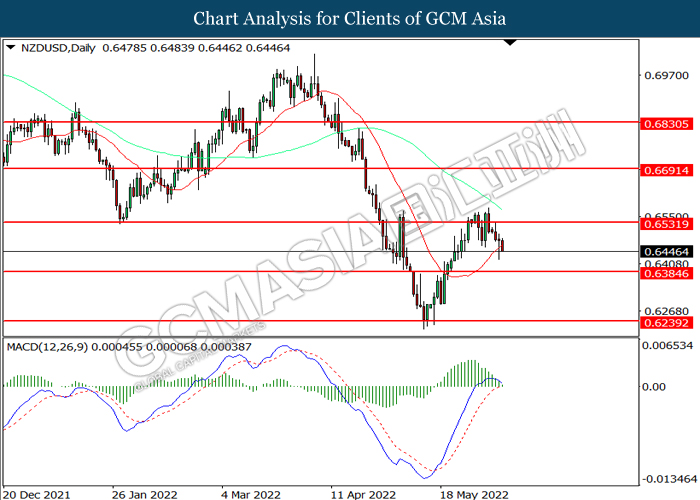

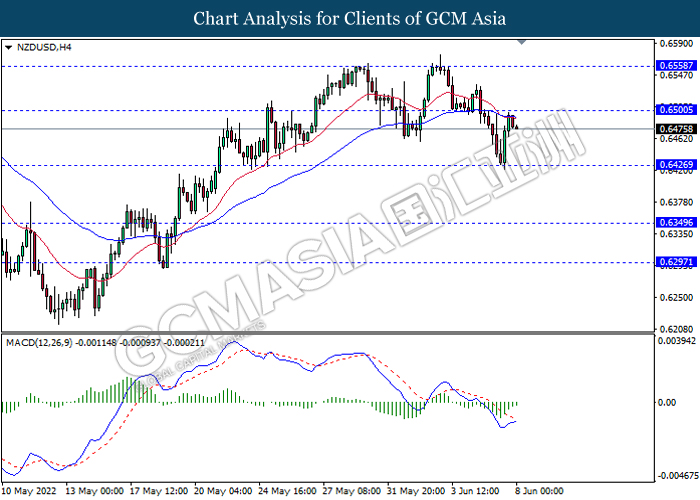

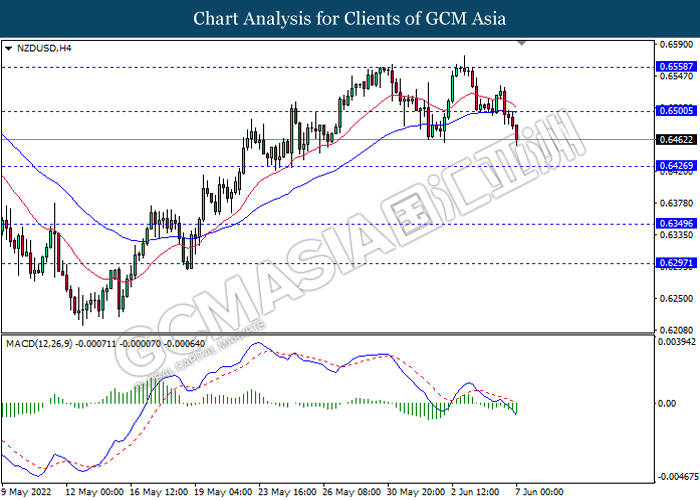

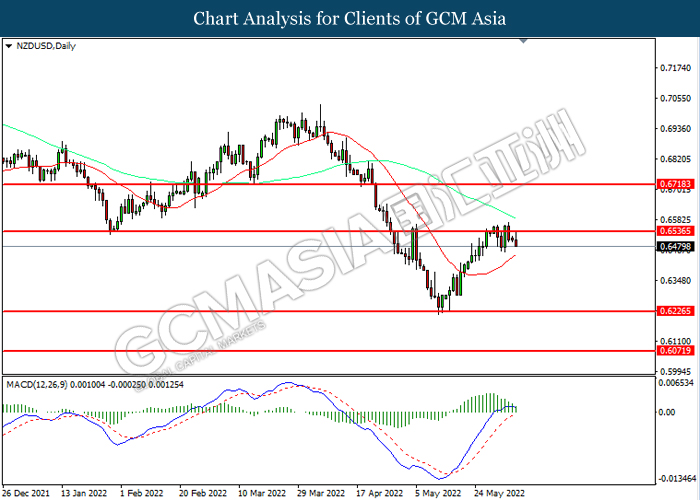

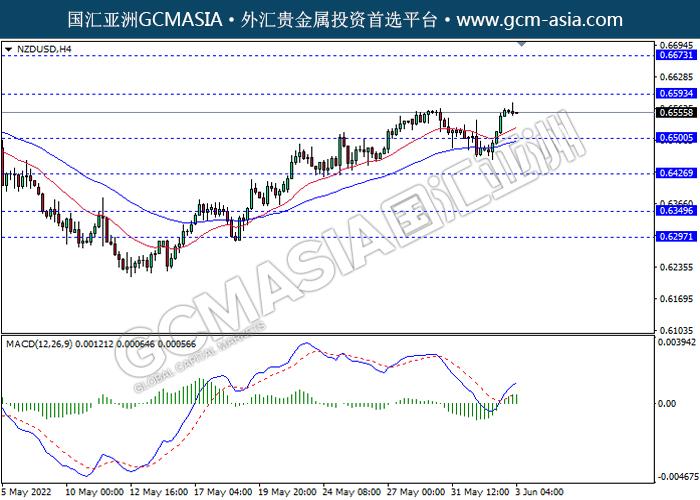

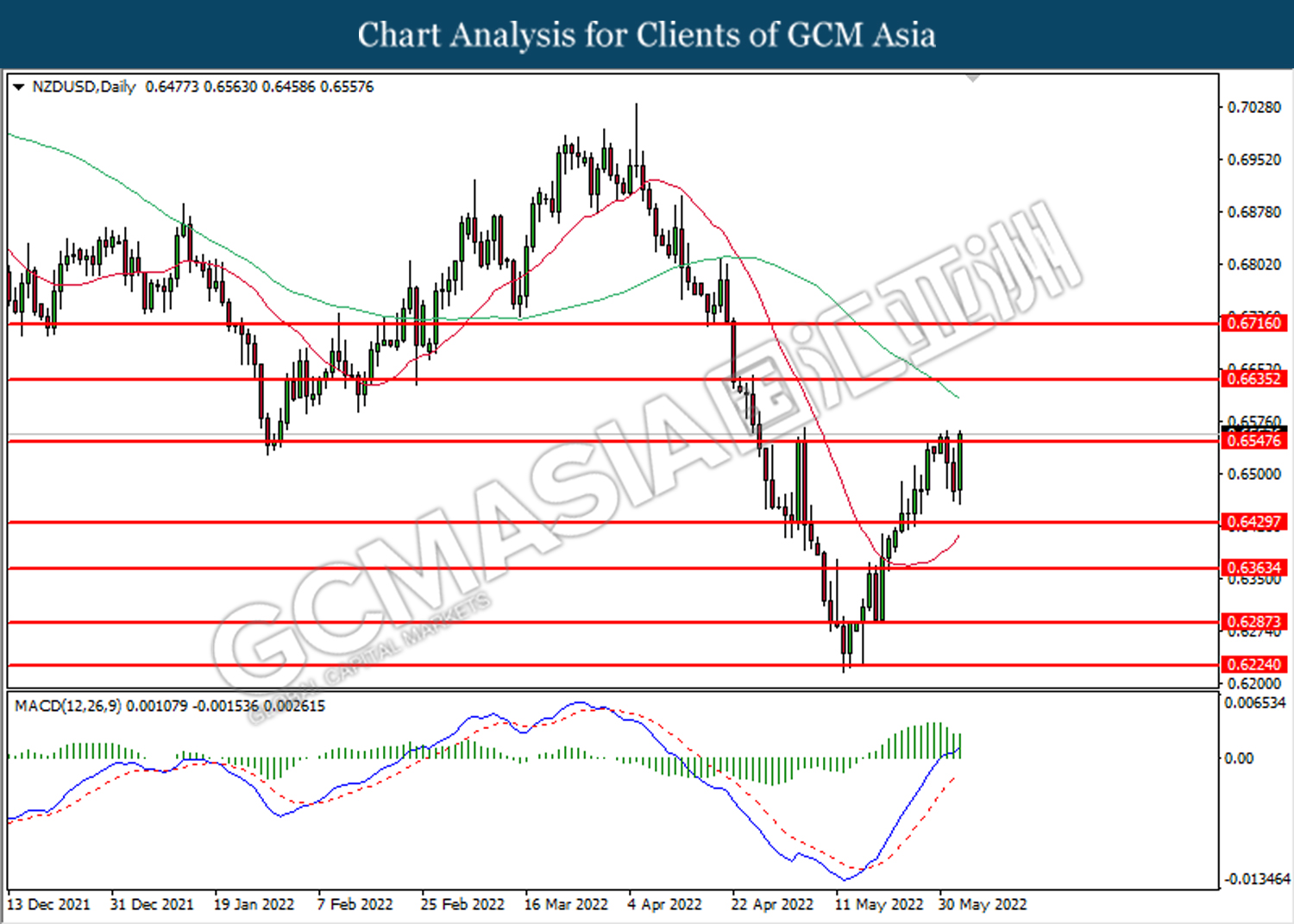

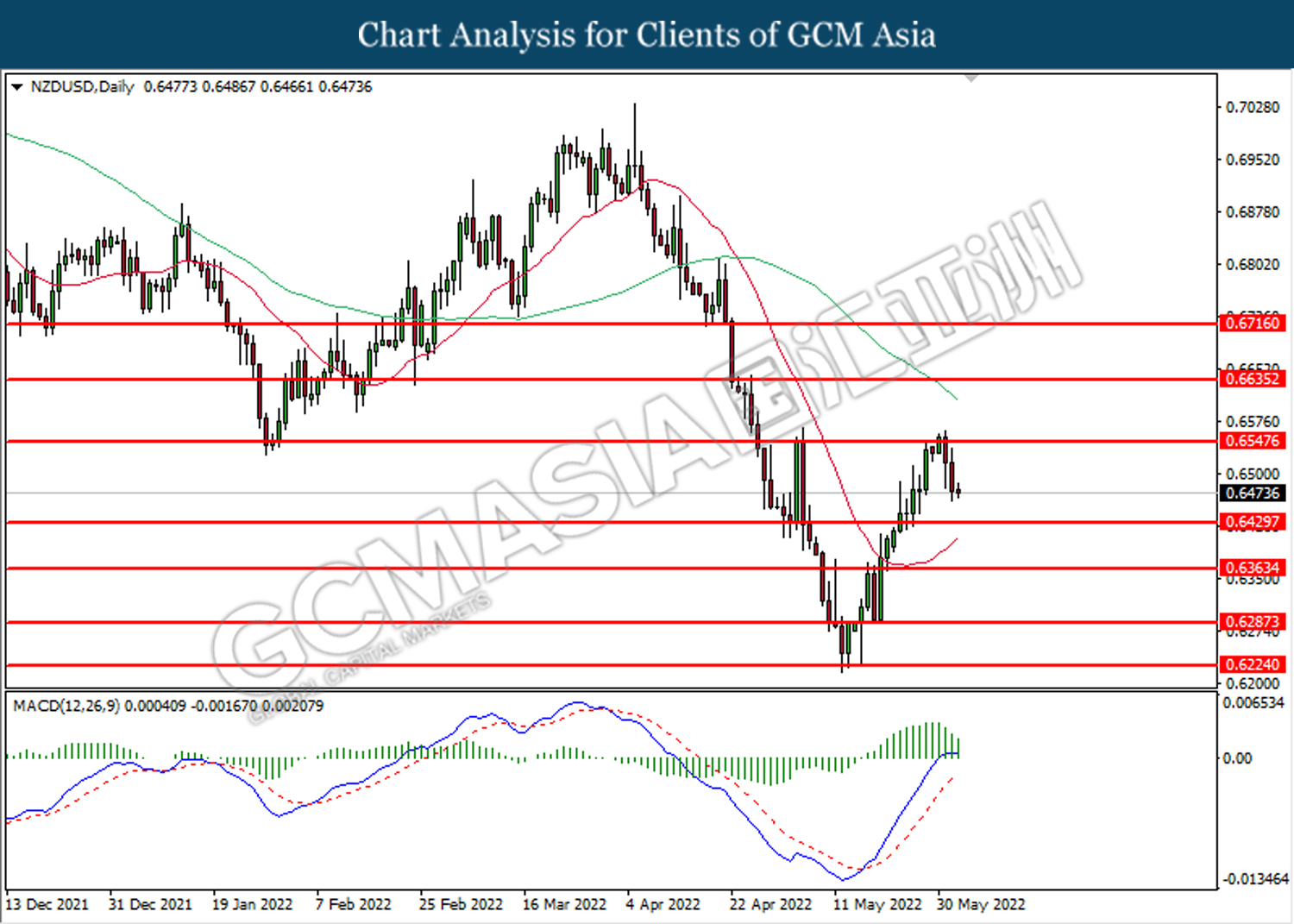

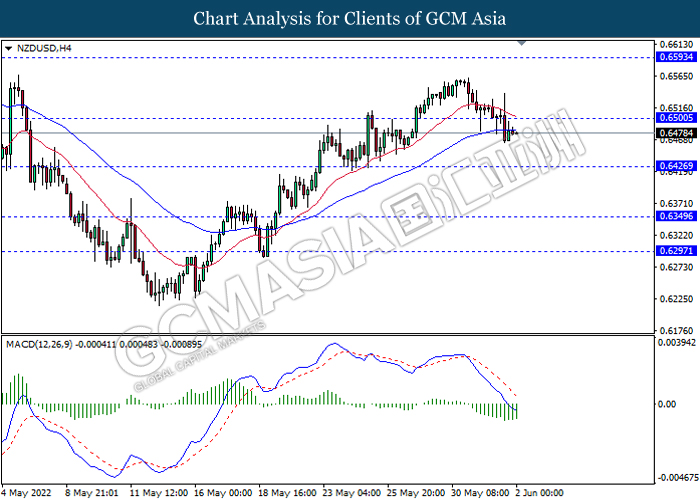

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6285. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully close below the support level.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

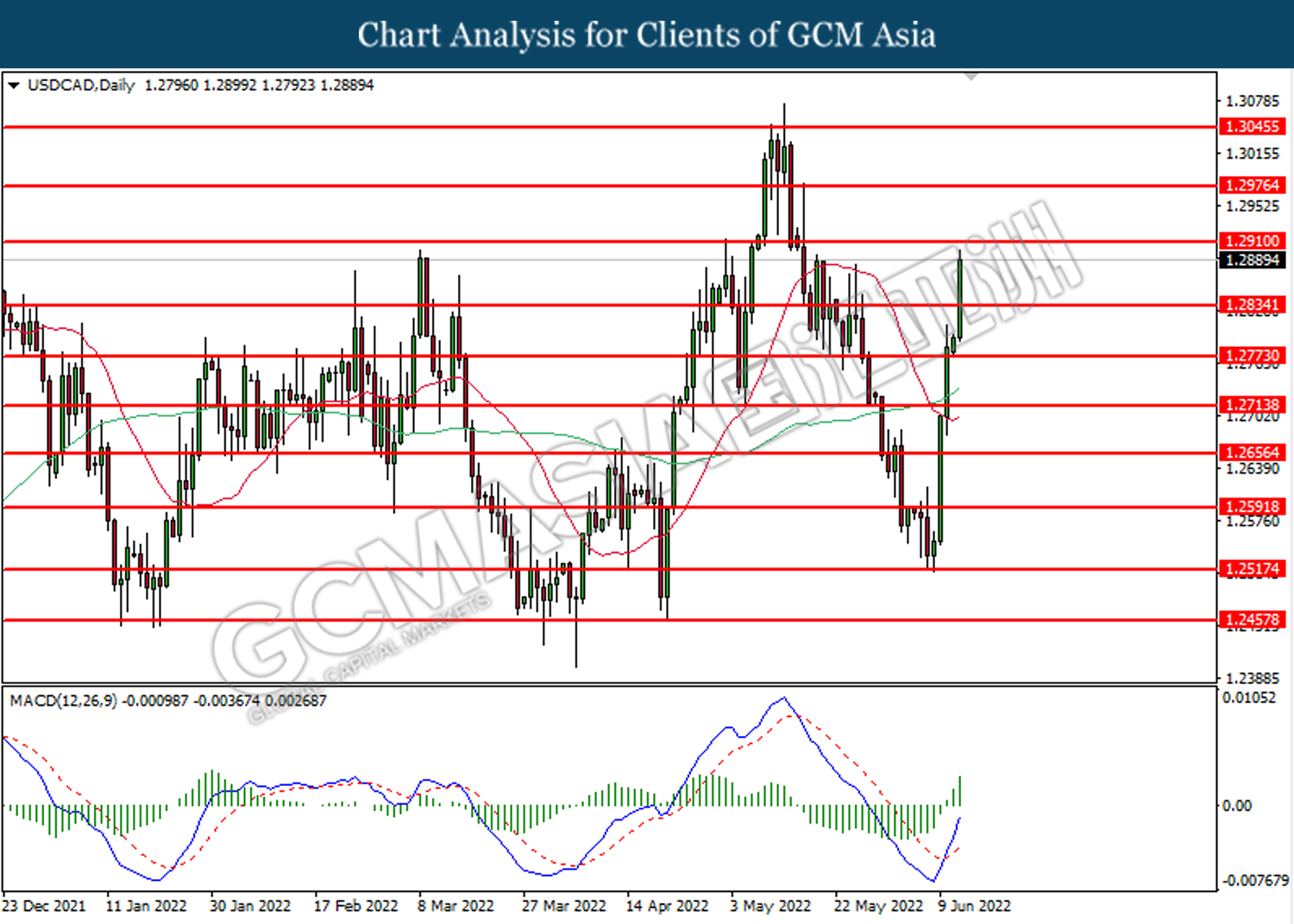

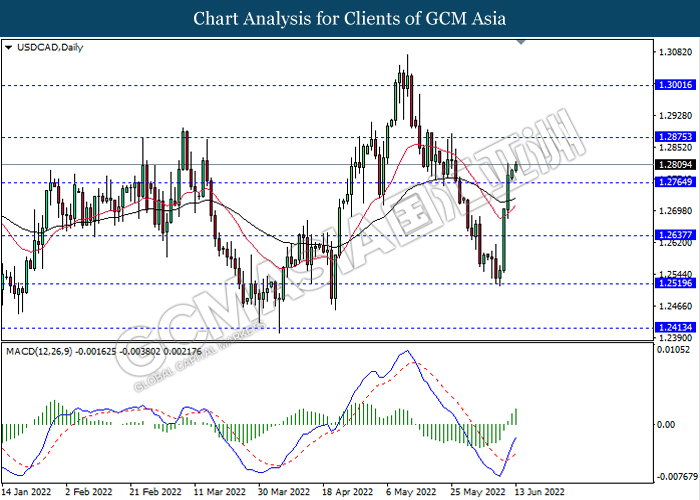

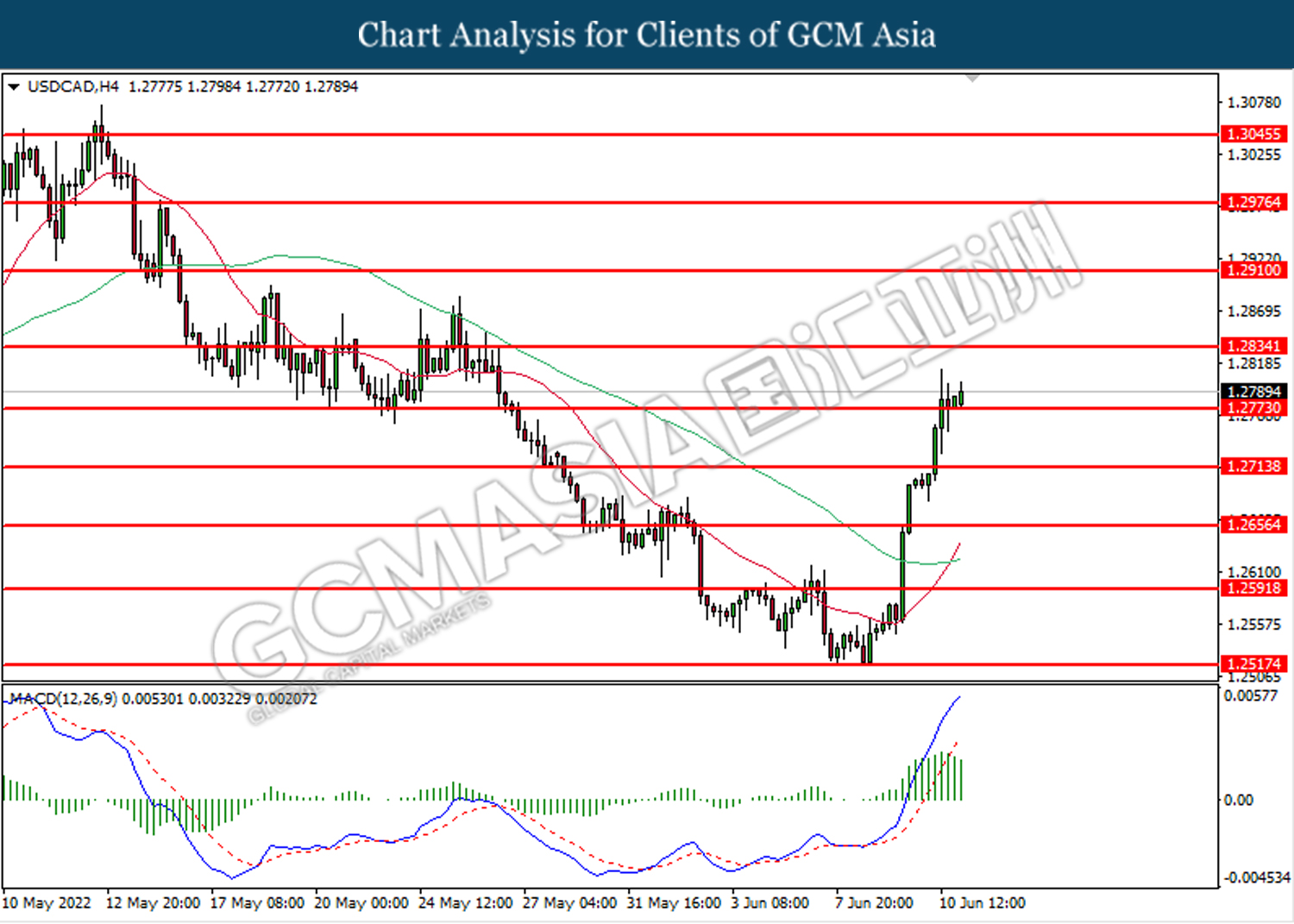

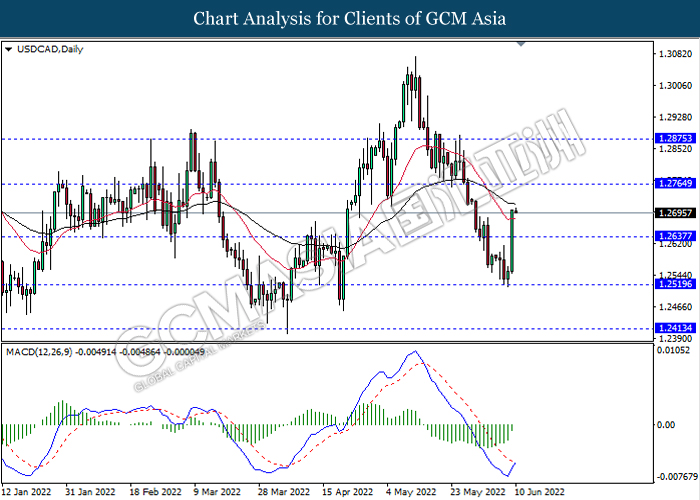

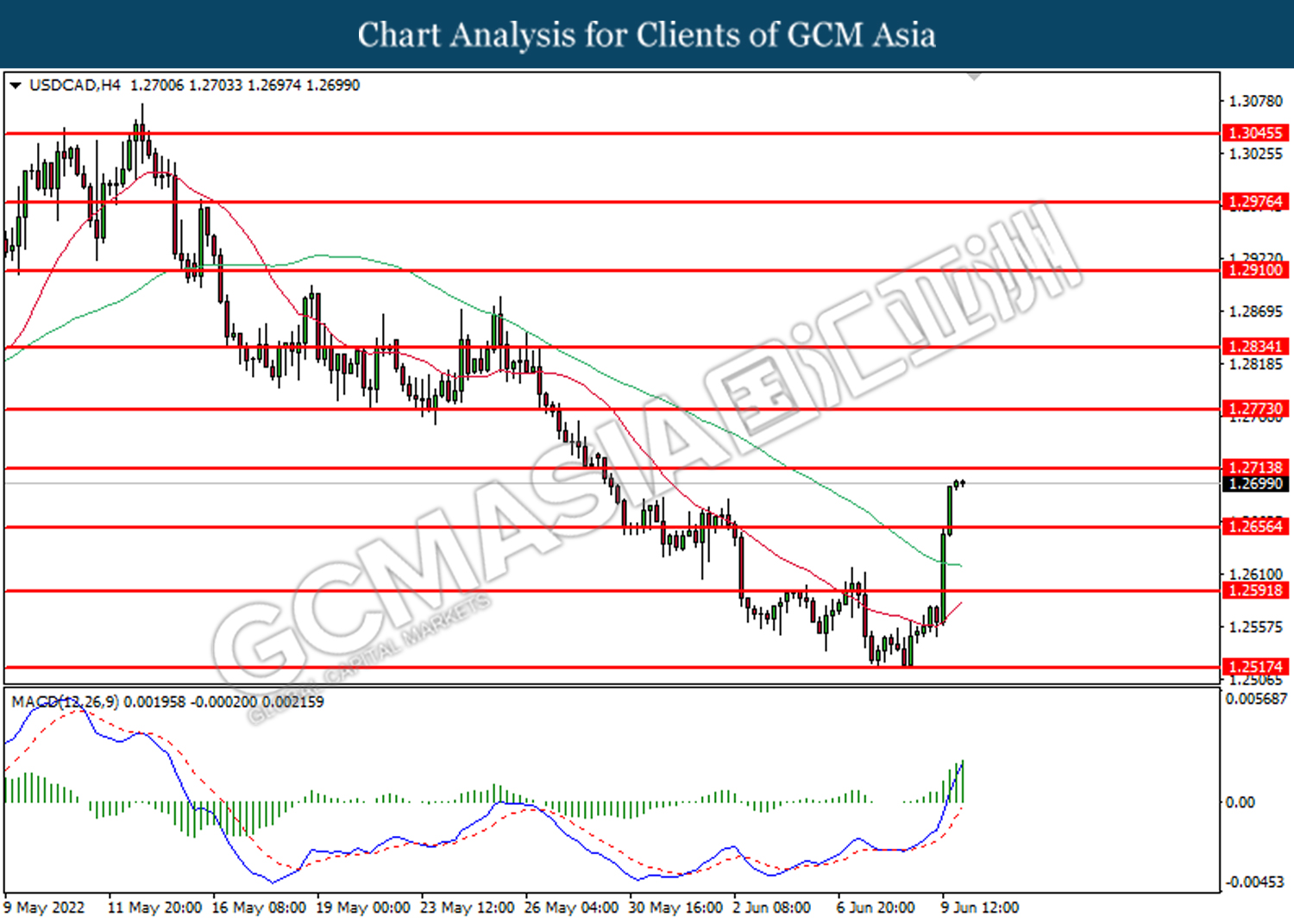

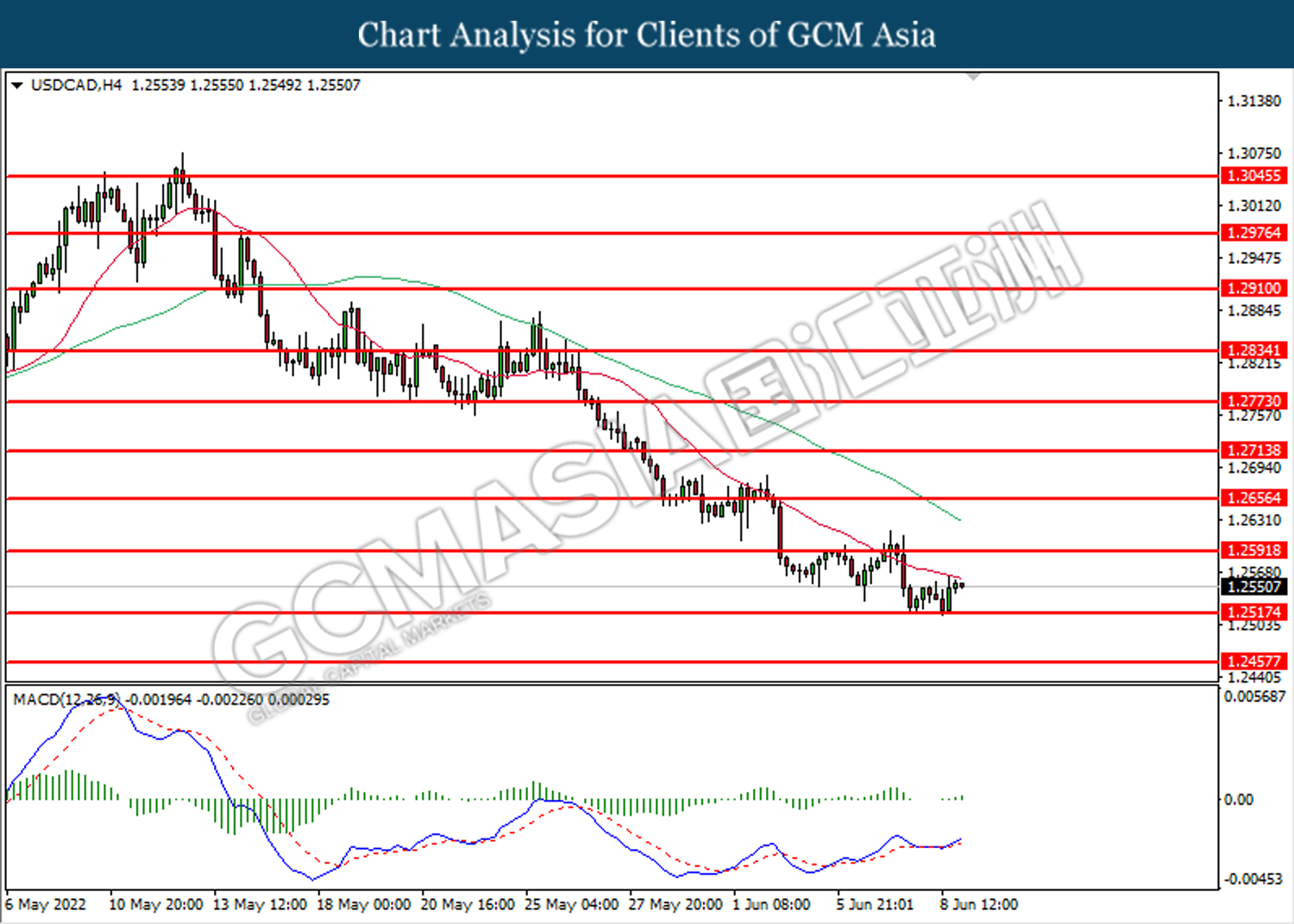

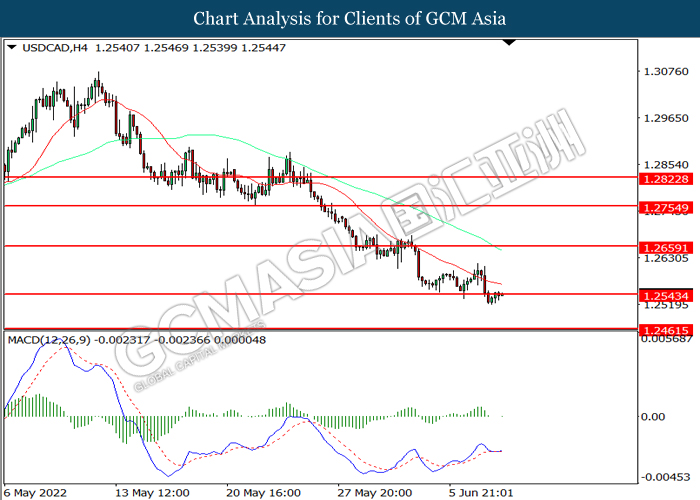

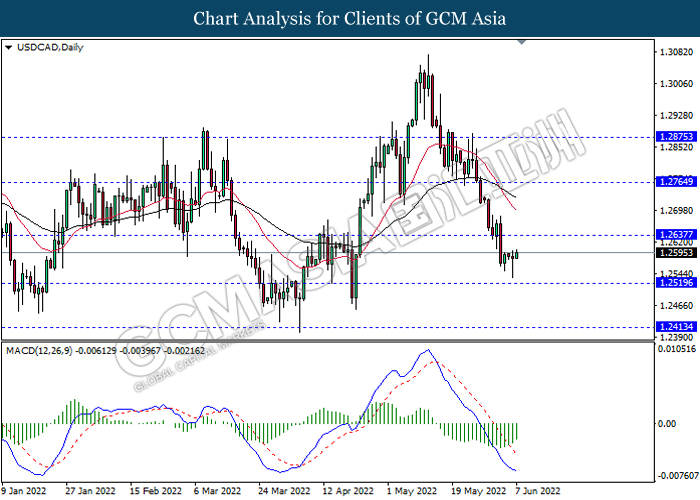

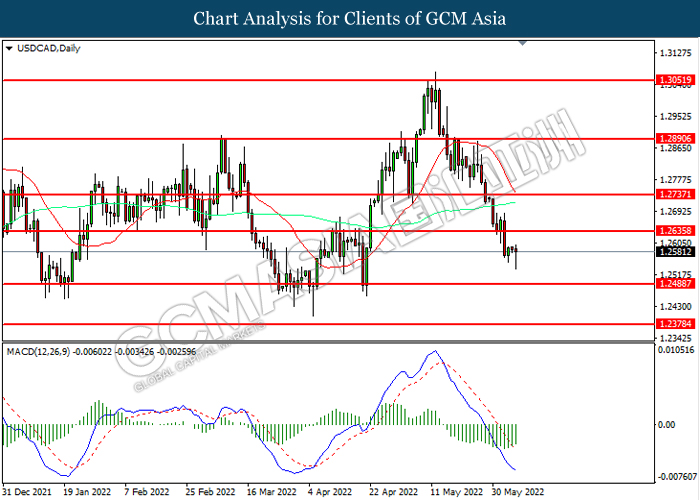

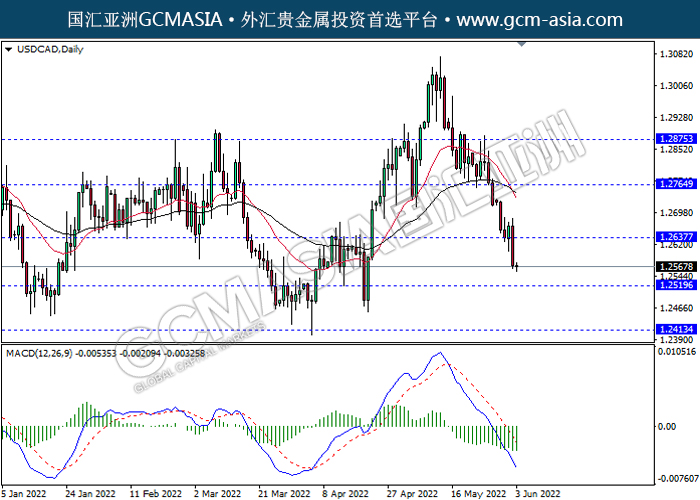

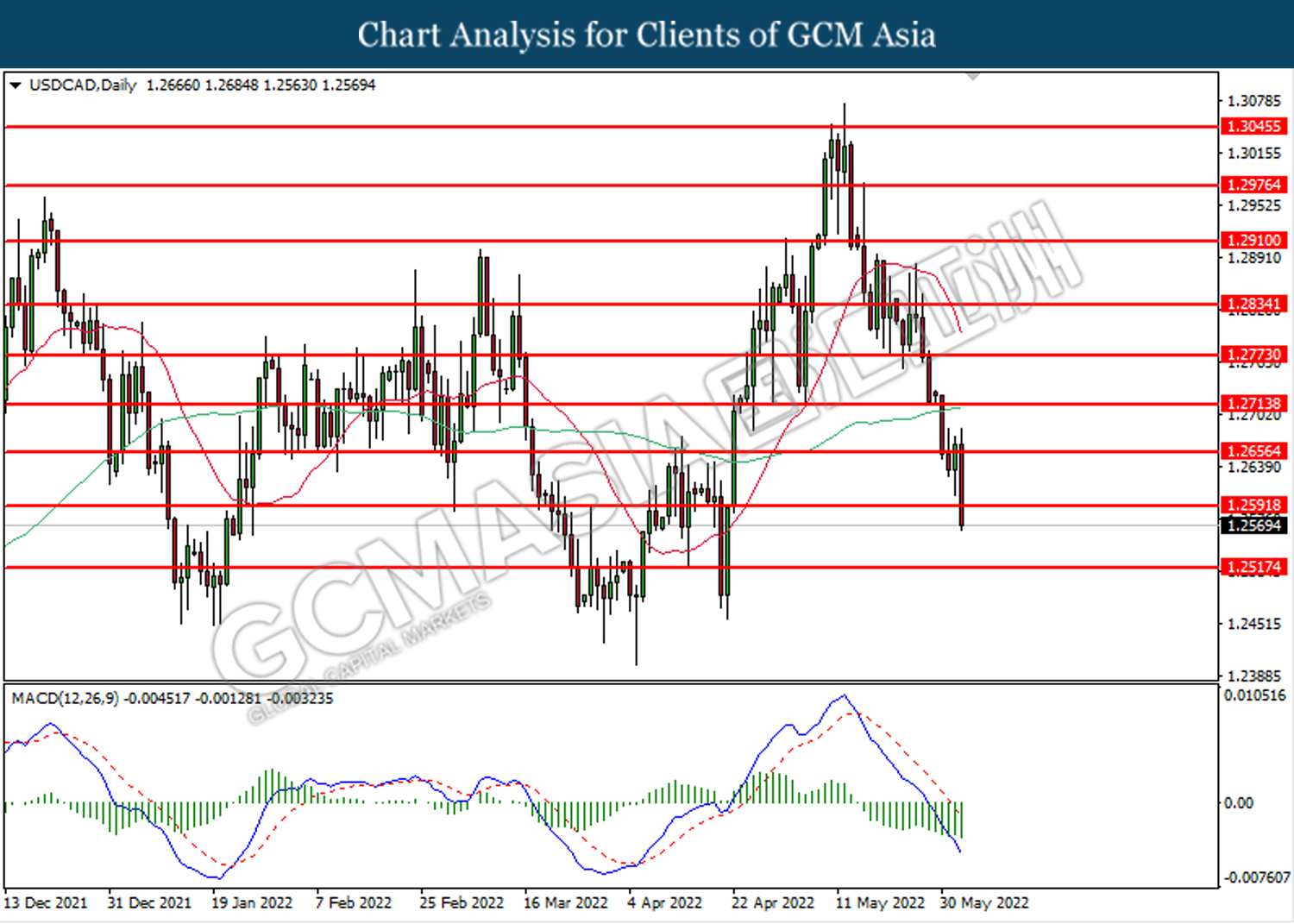

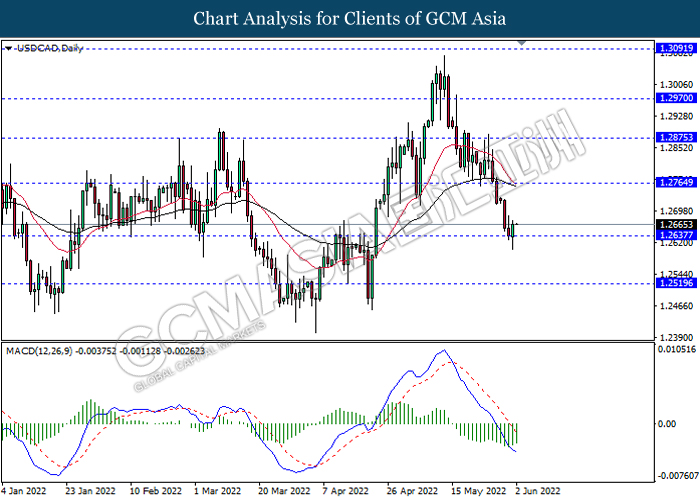

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2835. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2910.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2775

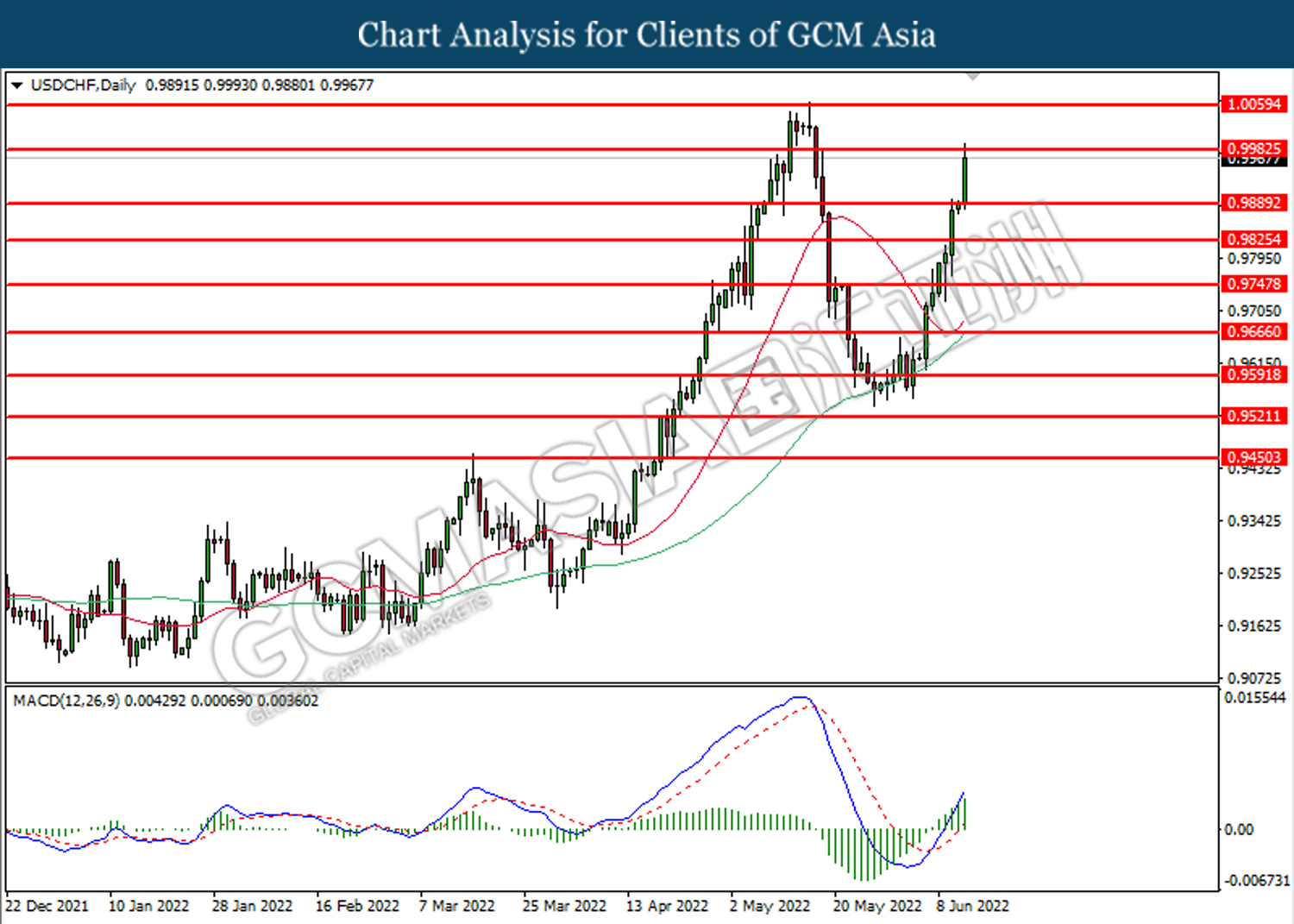

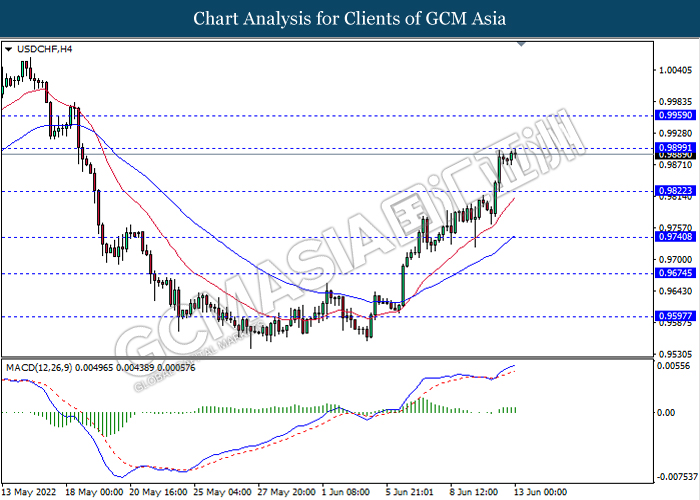

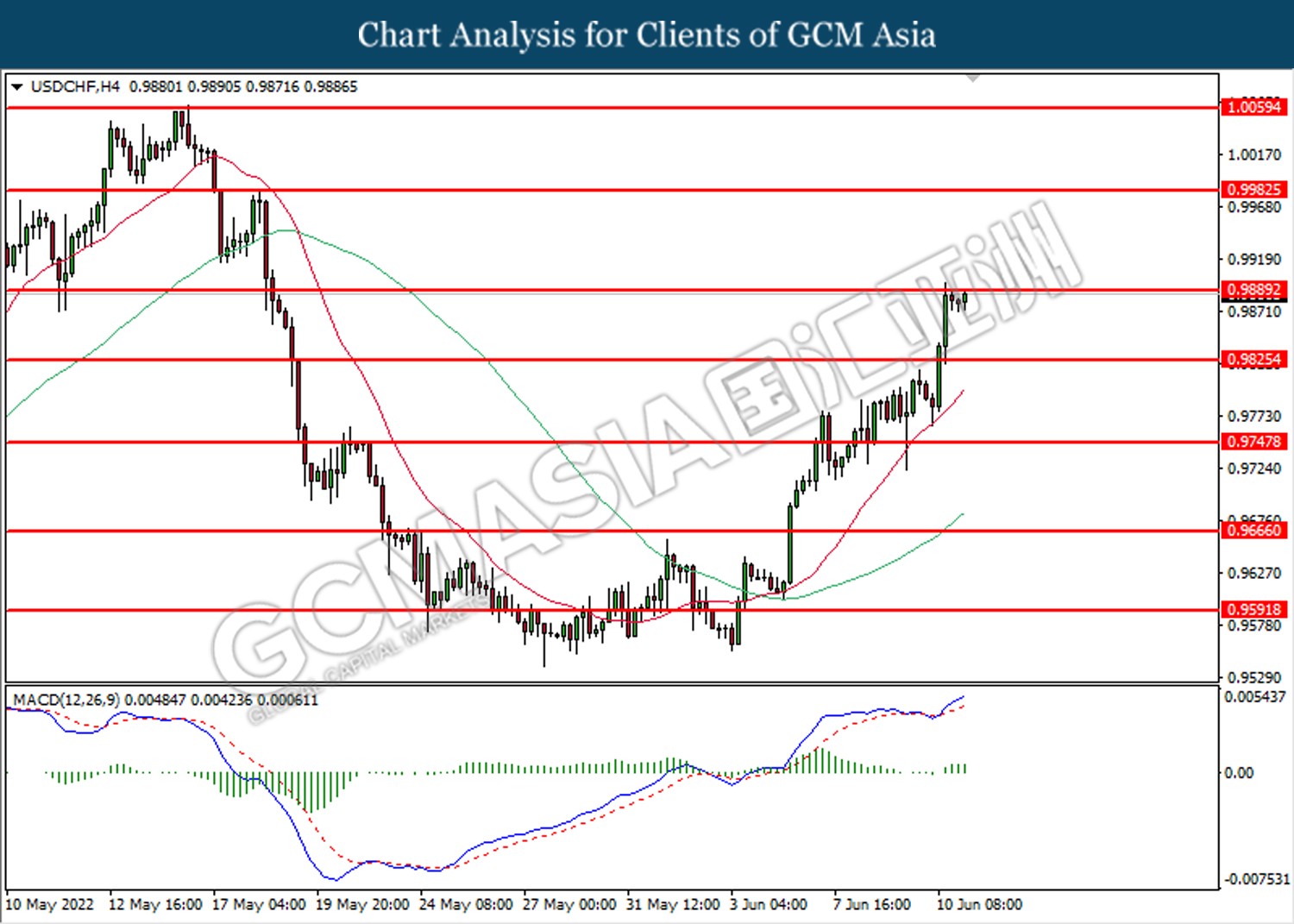

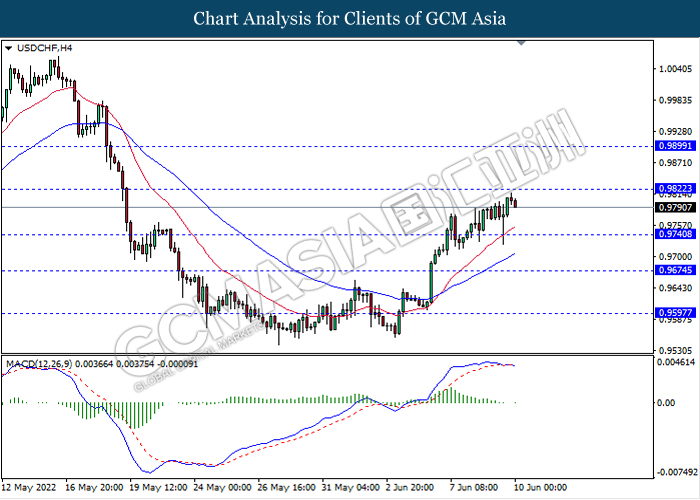

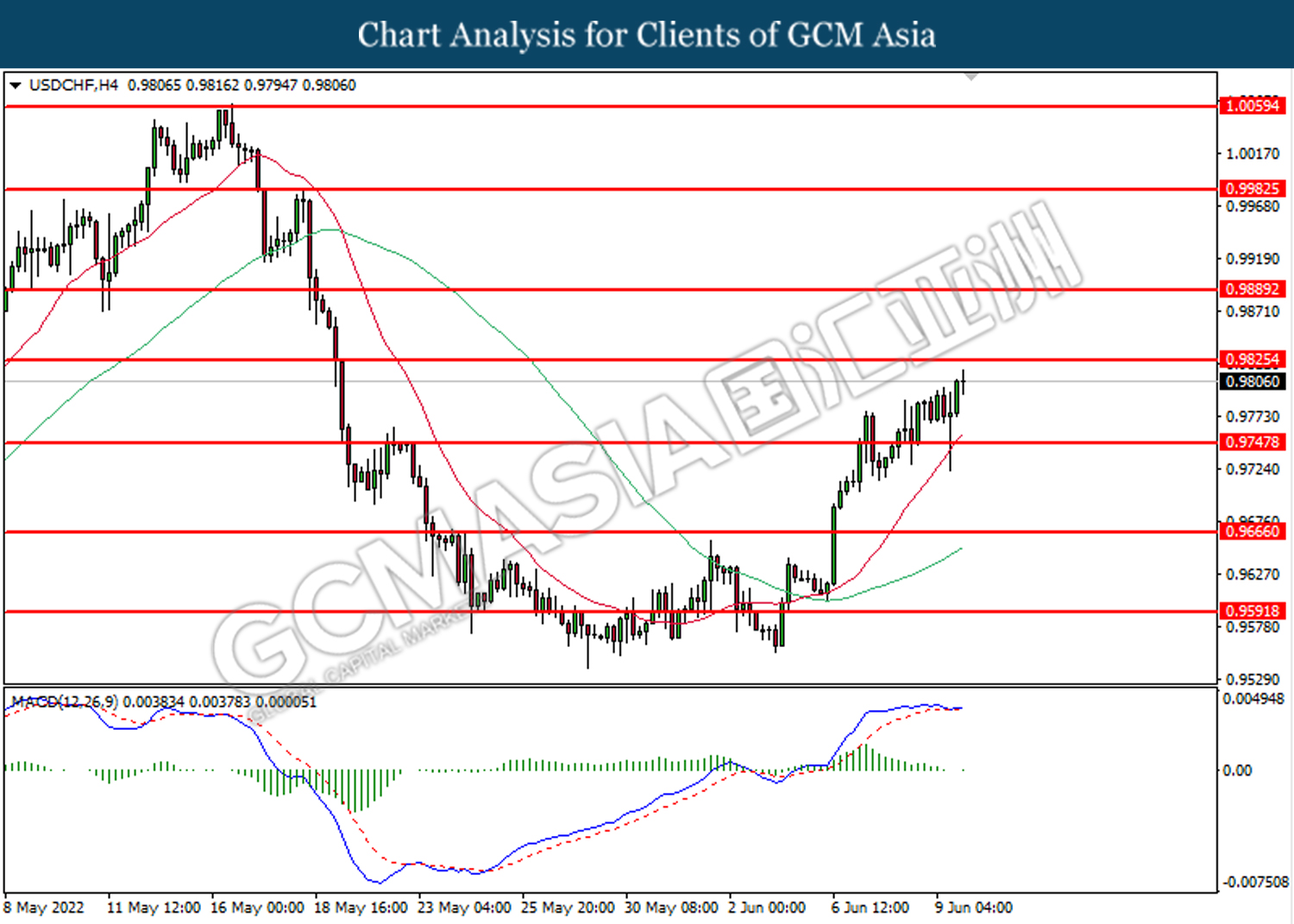

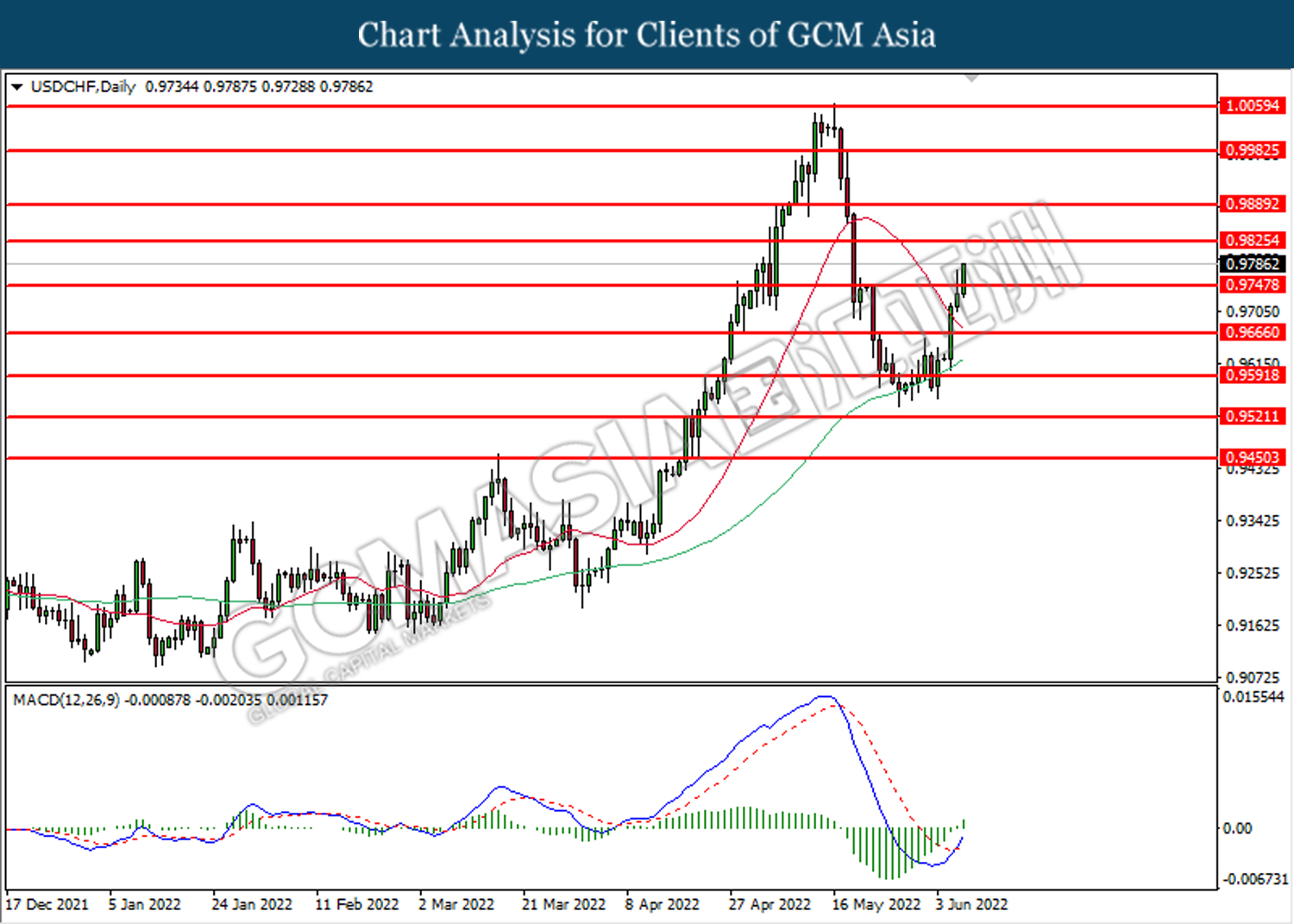

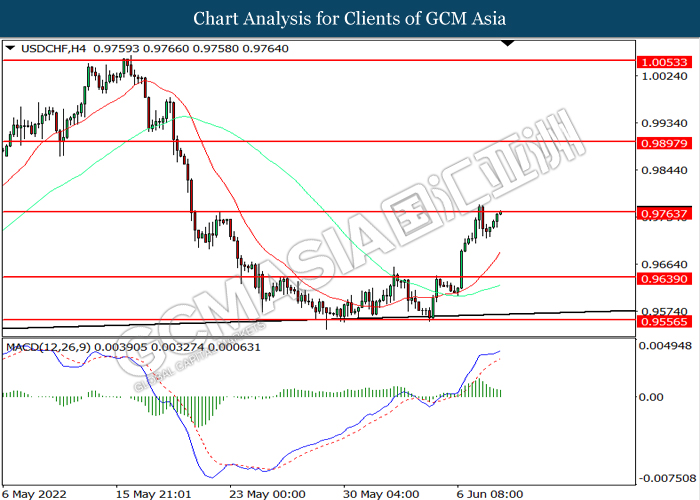

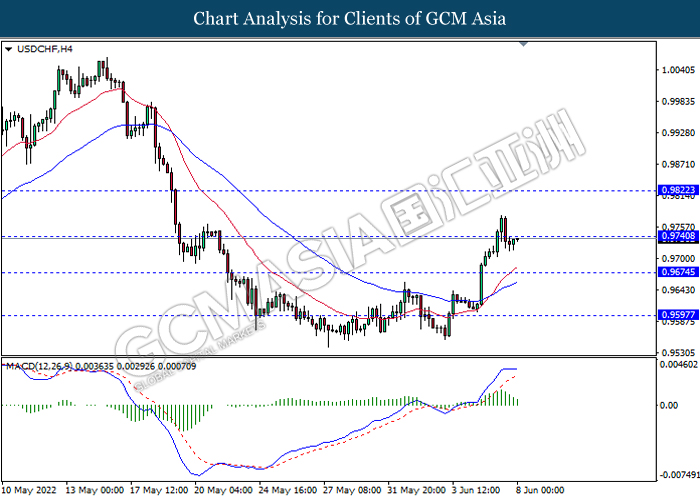

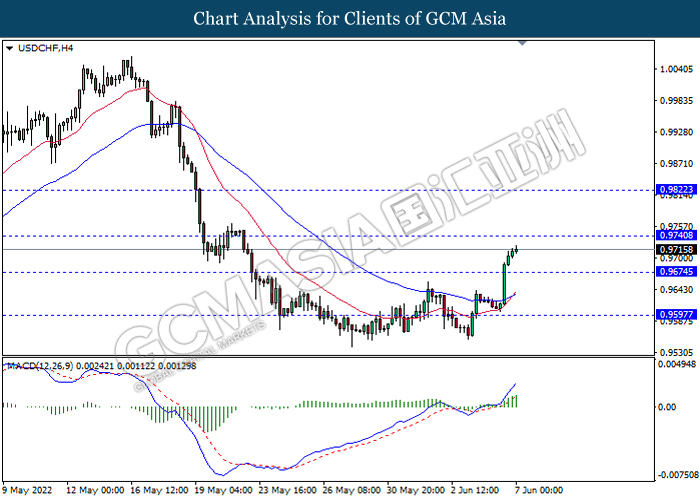

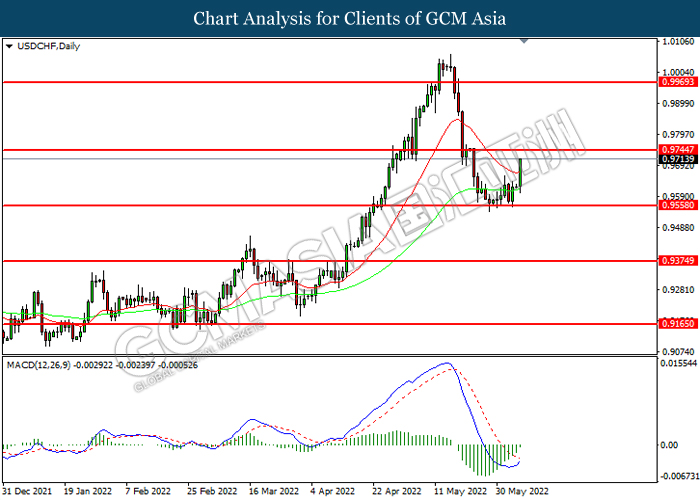

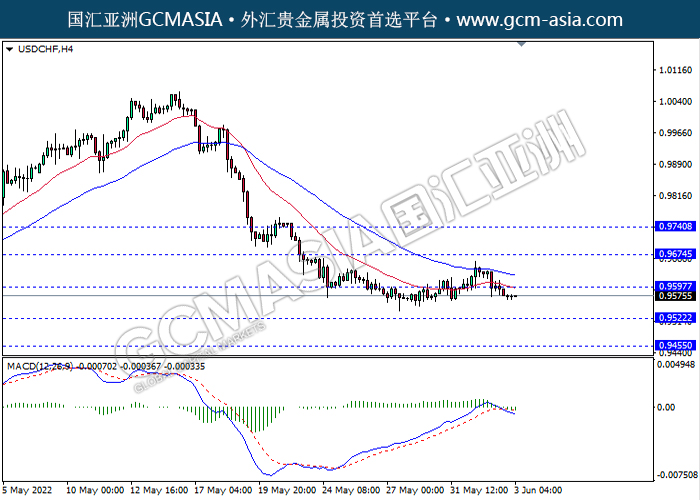

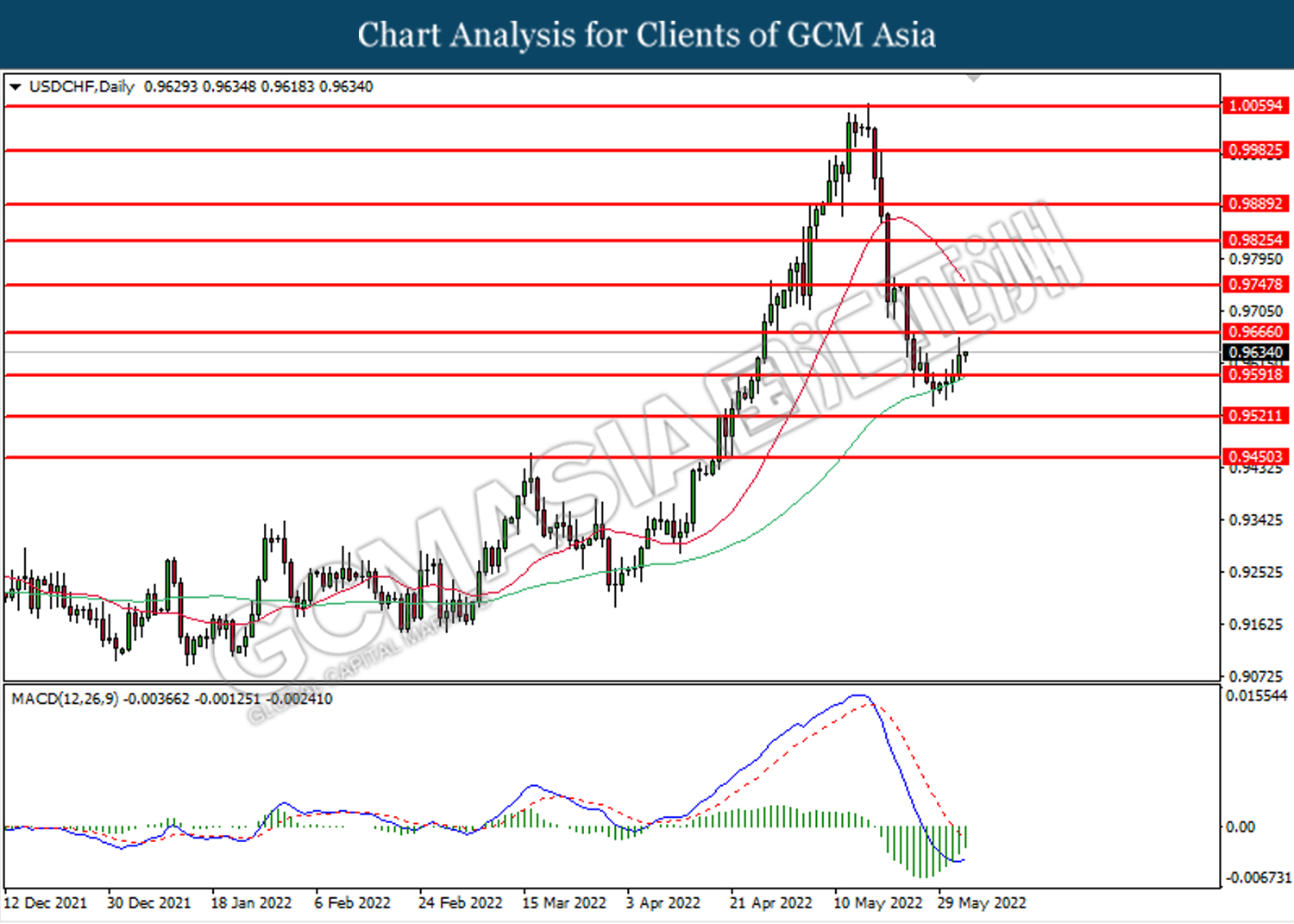

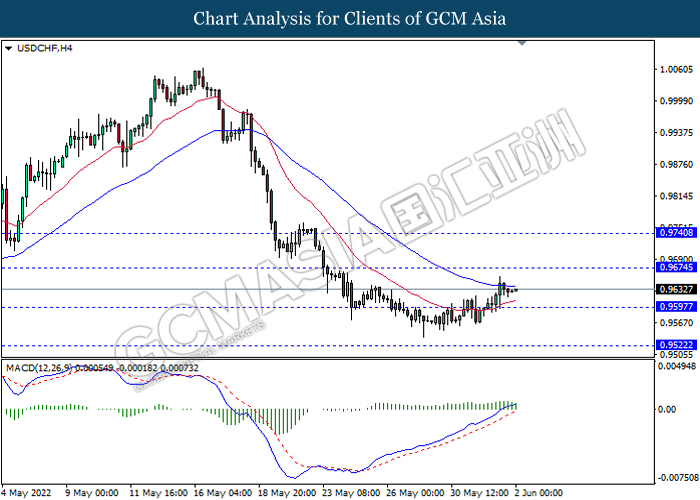

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9980. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9980, 1.0060

Support level: 0.9890, 0.9825

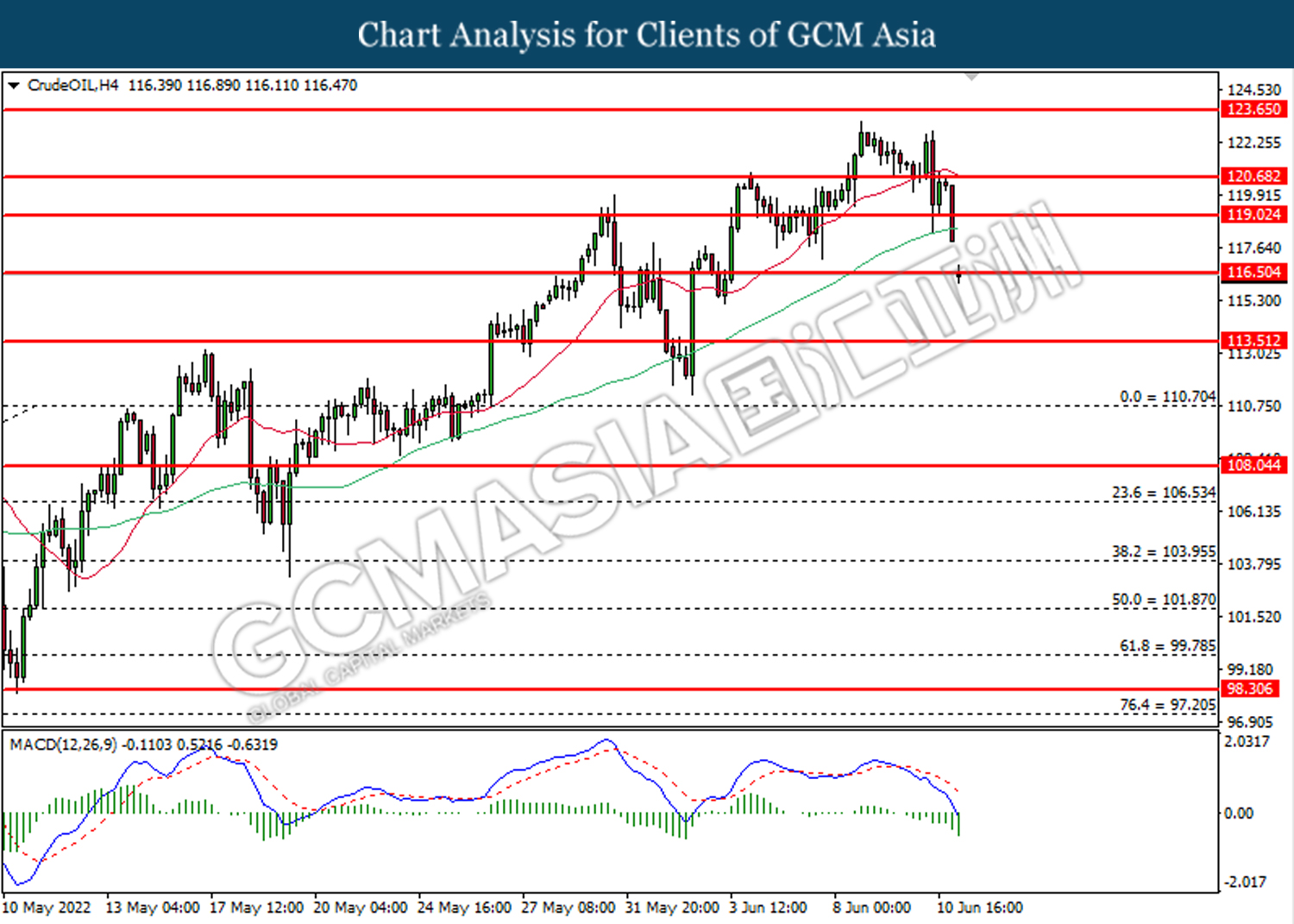

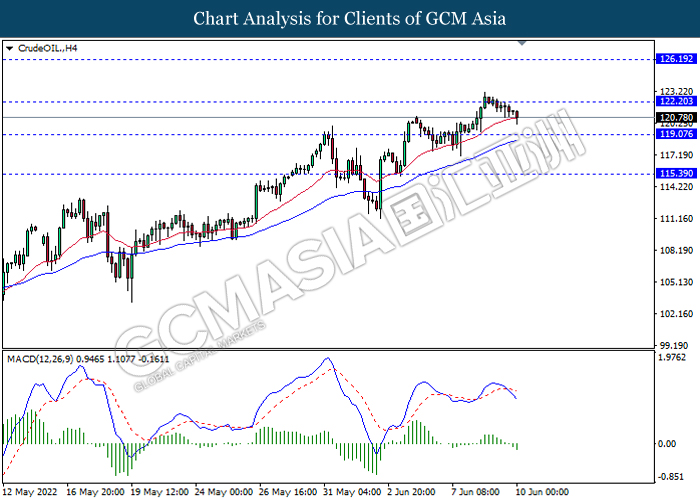

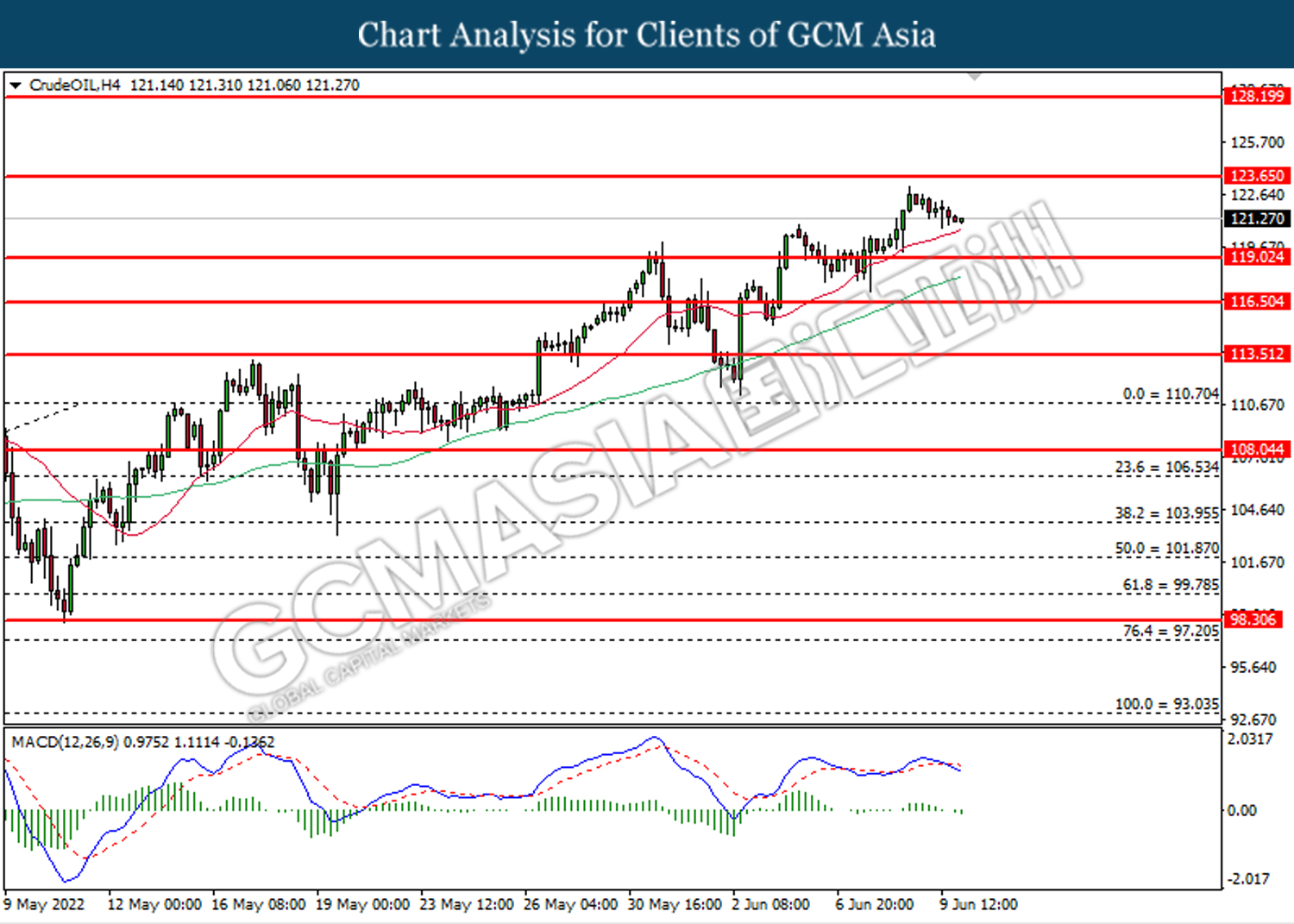

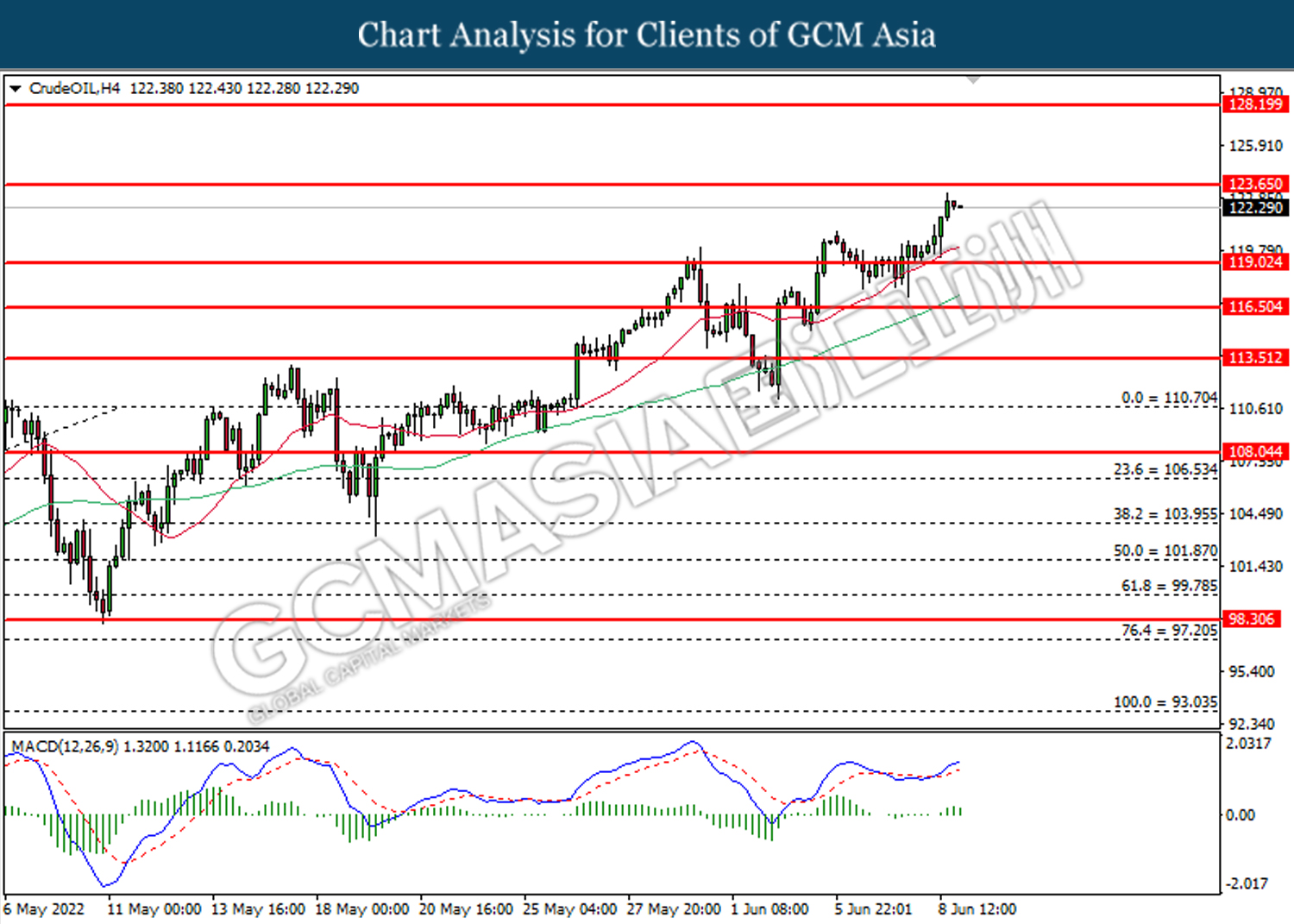

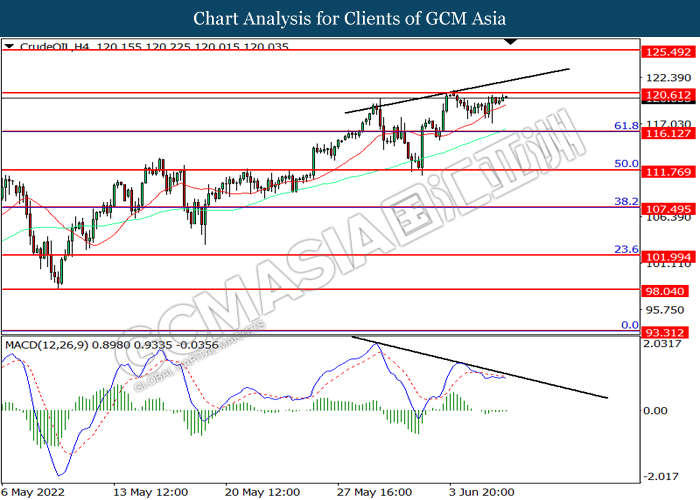

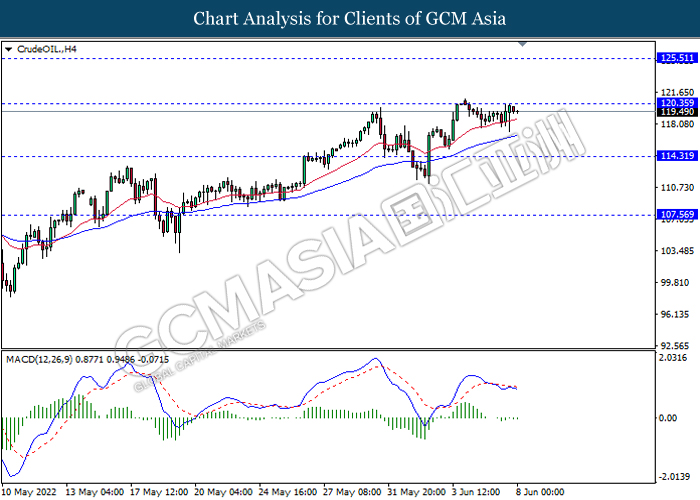

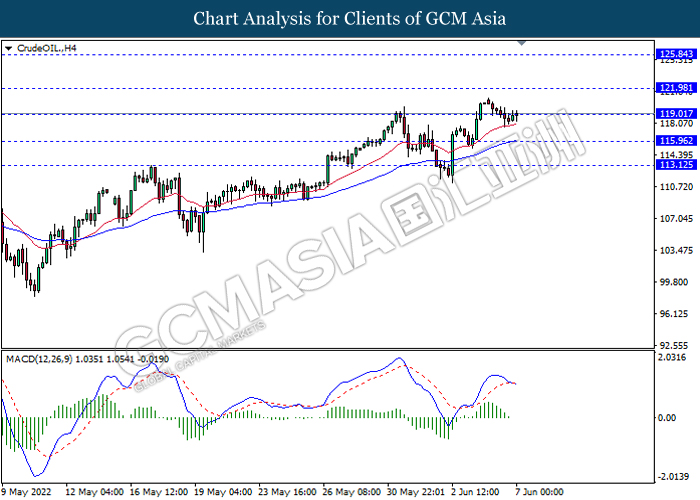

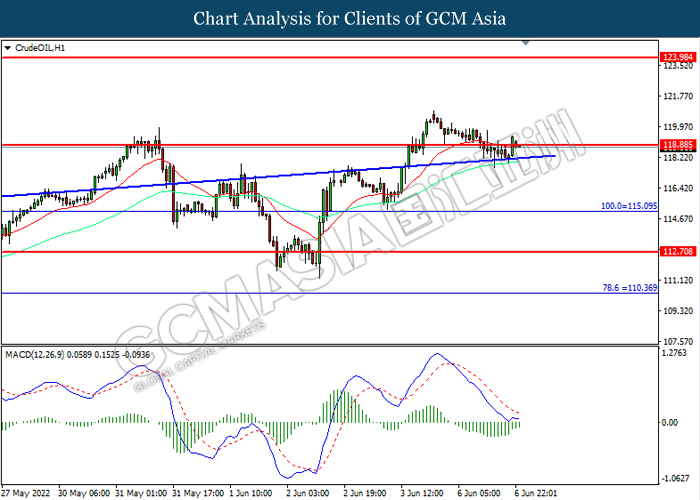

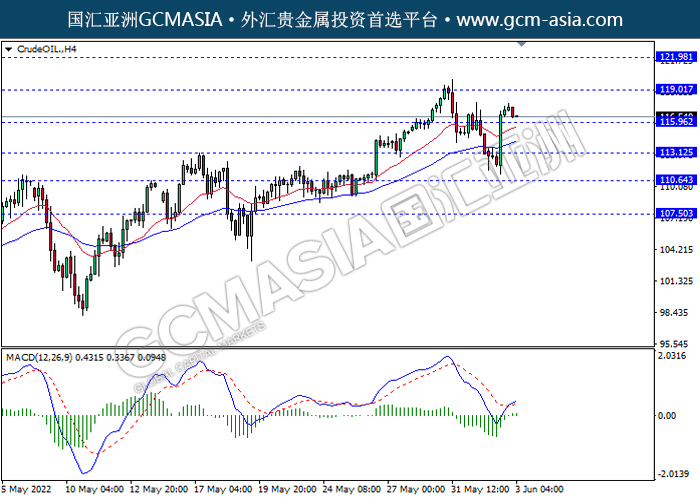

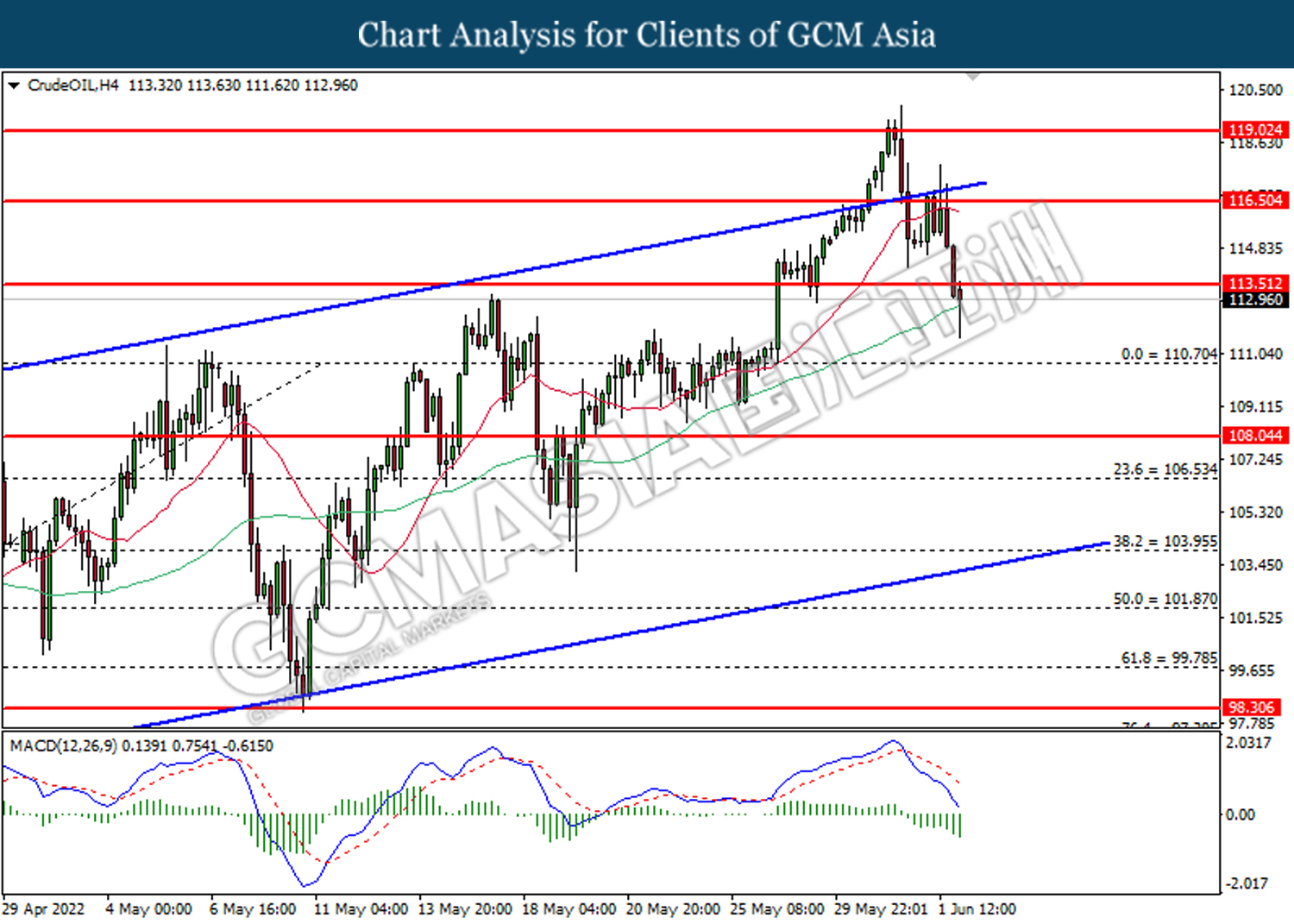

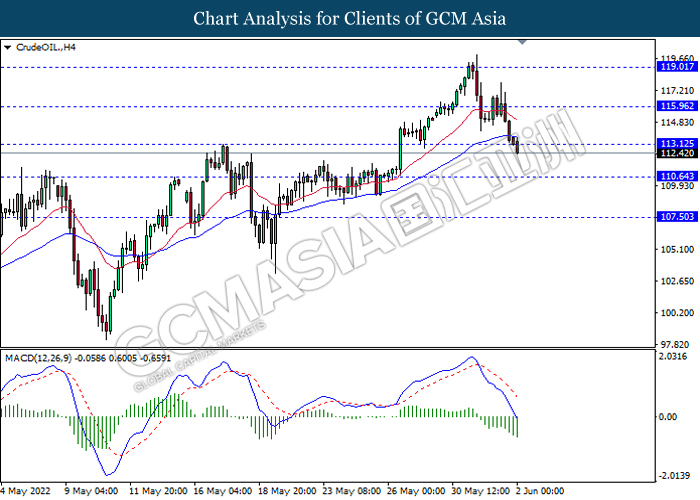

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 119.00. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 119.00, 120.70

Support level: 116.50, 113.50

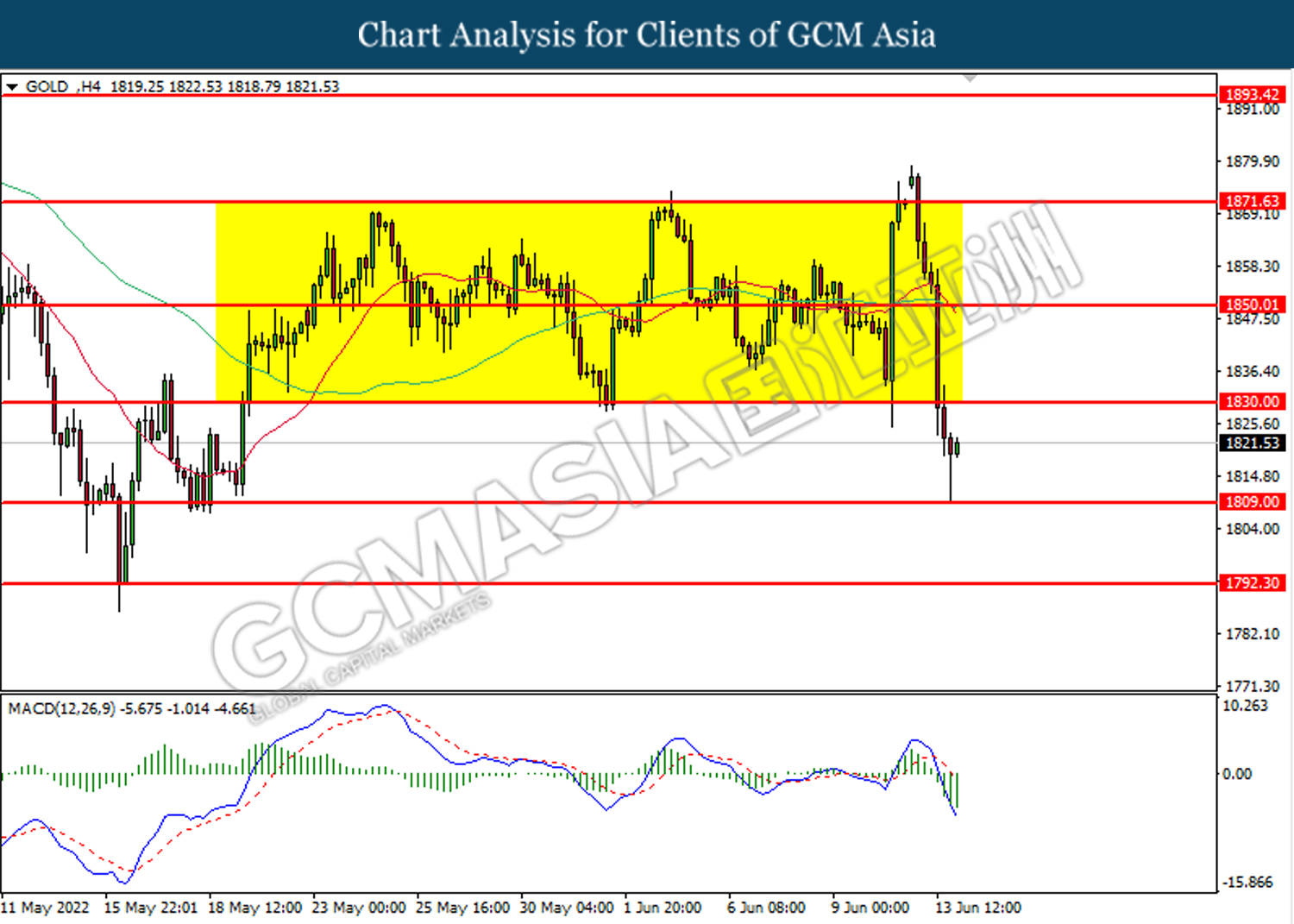

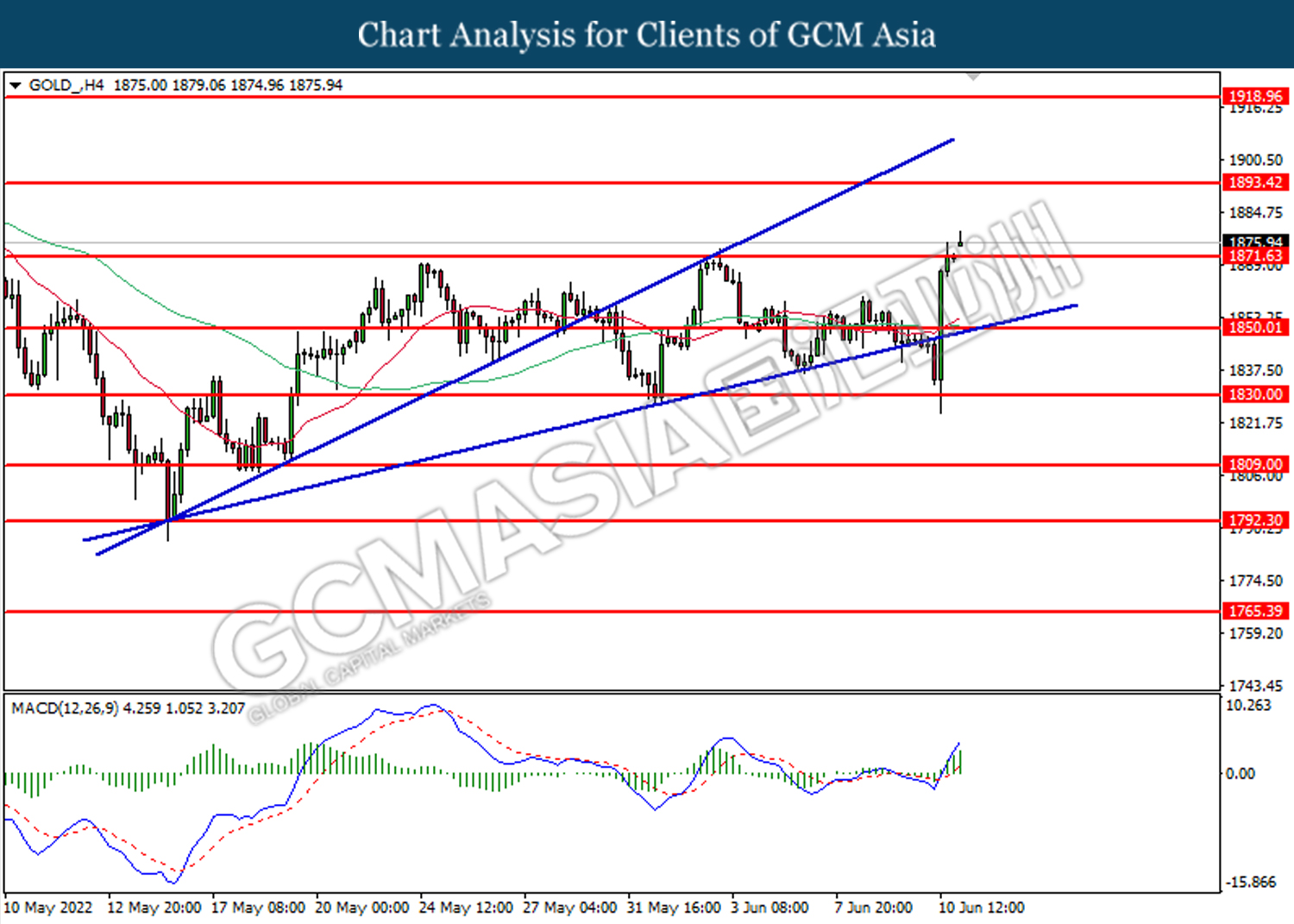

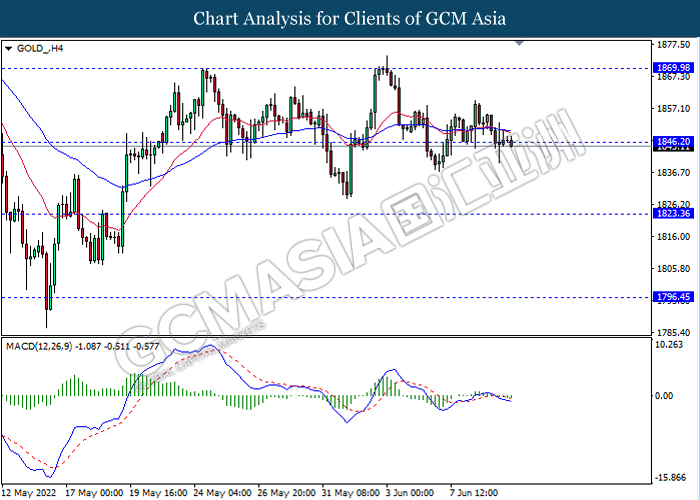

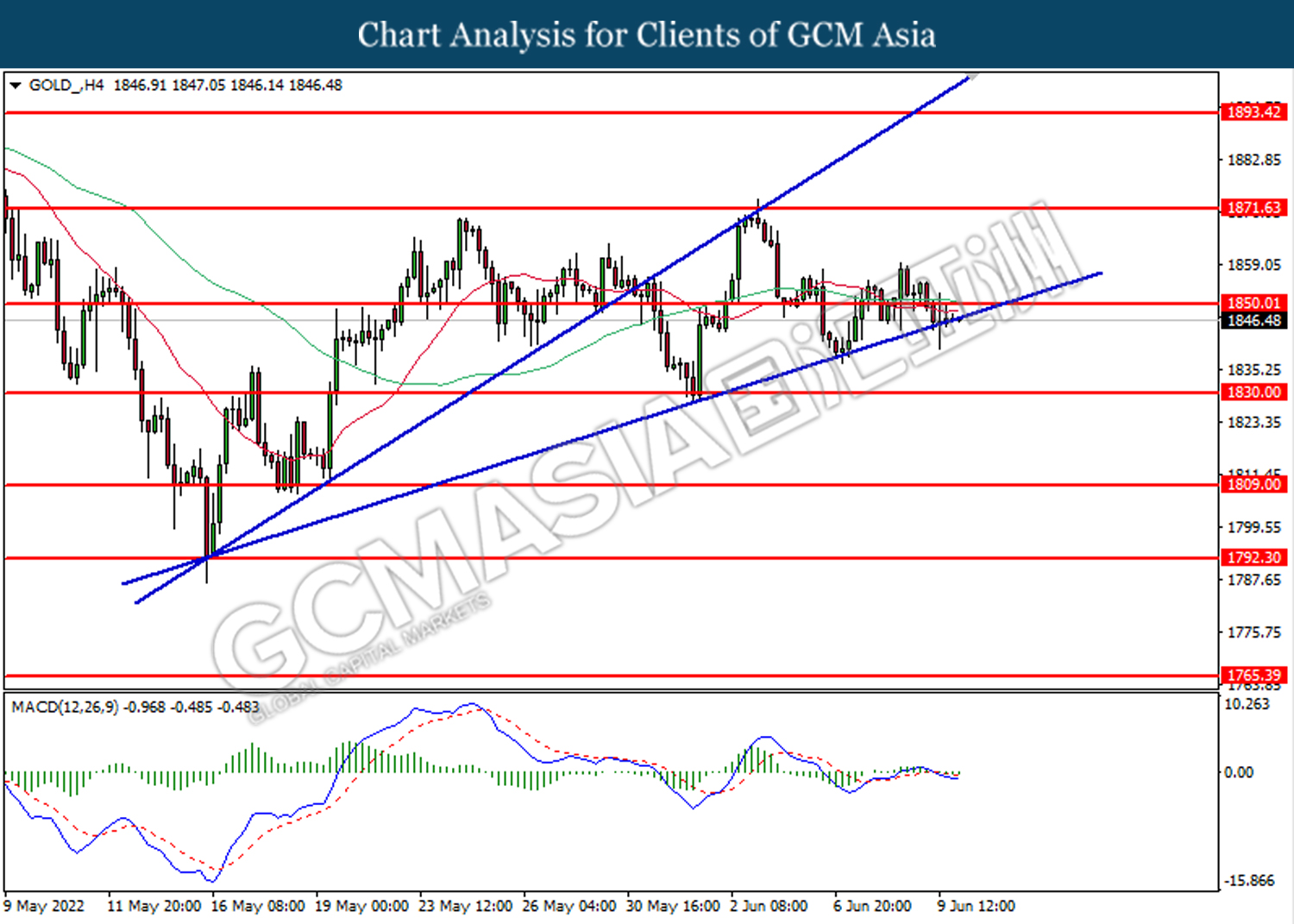

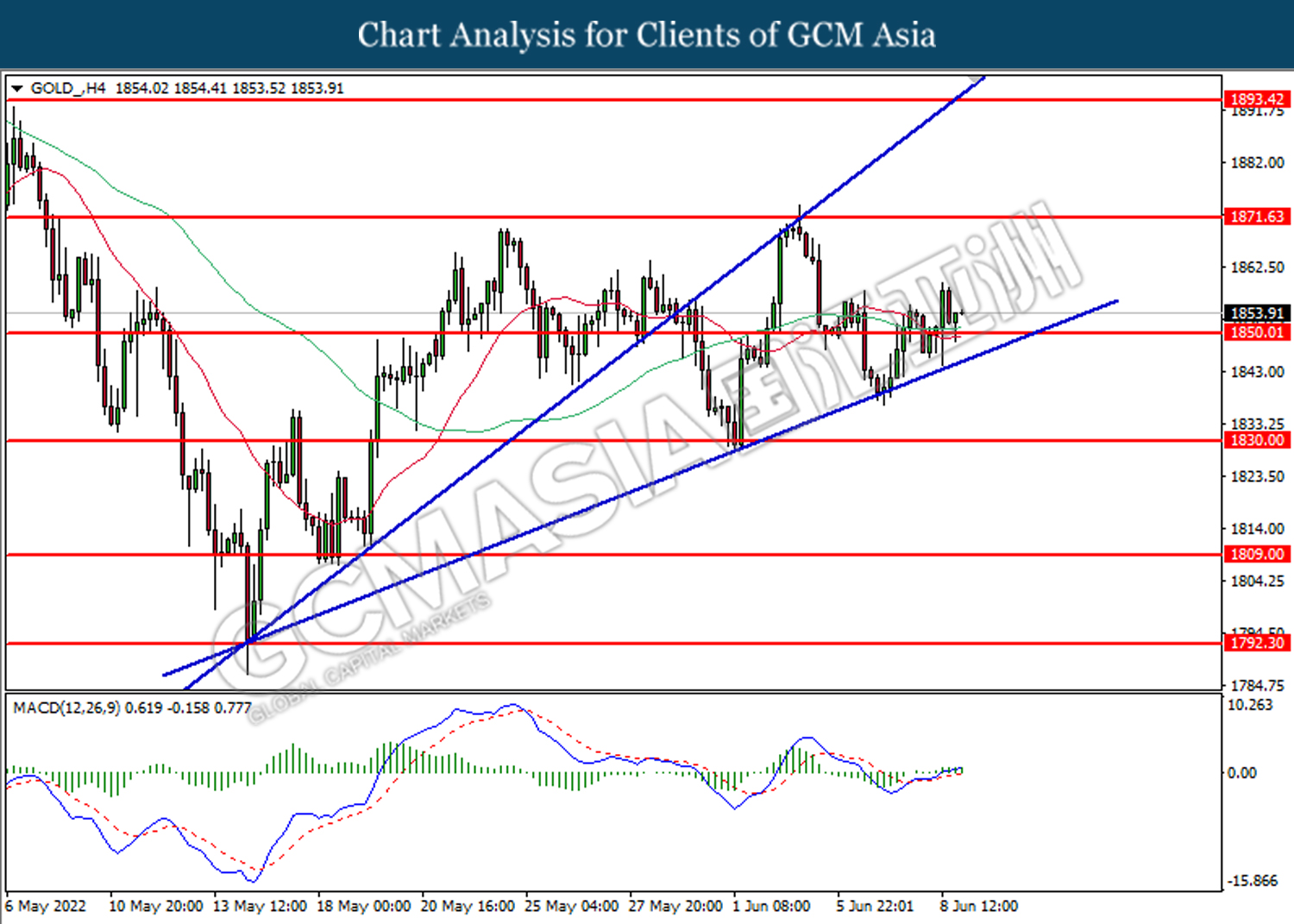

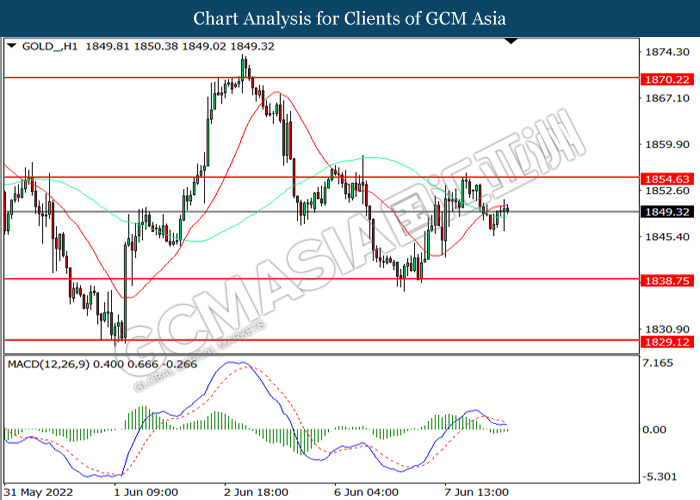

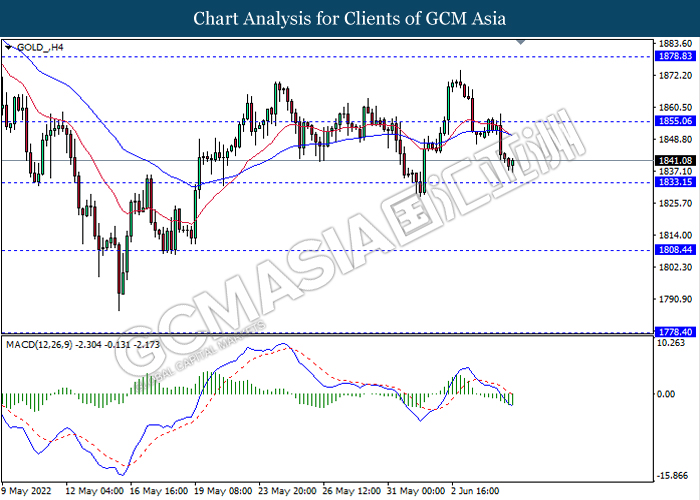

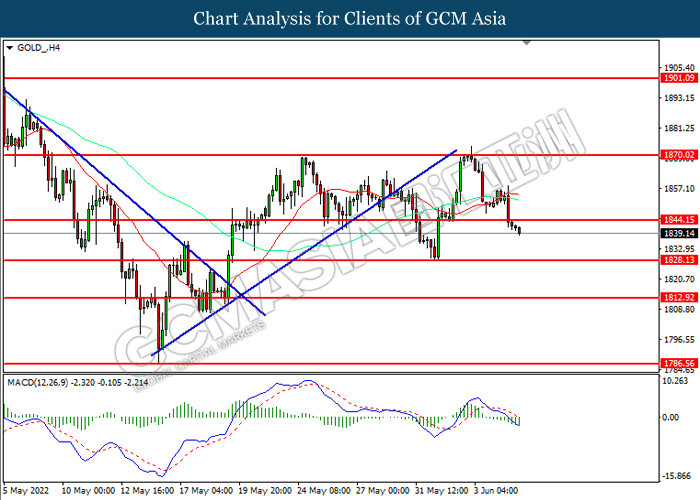

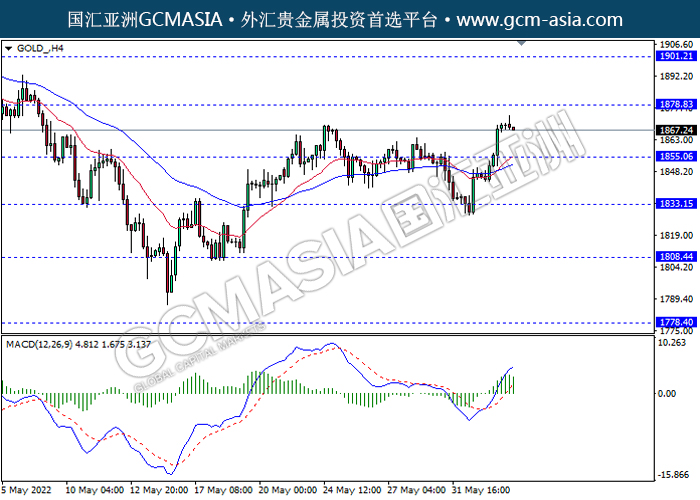

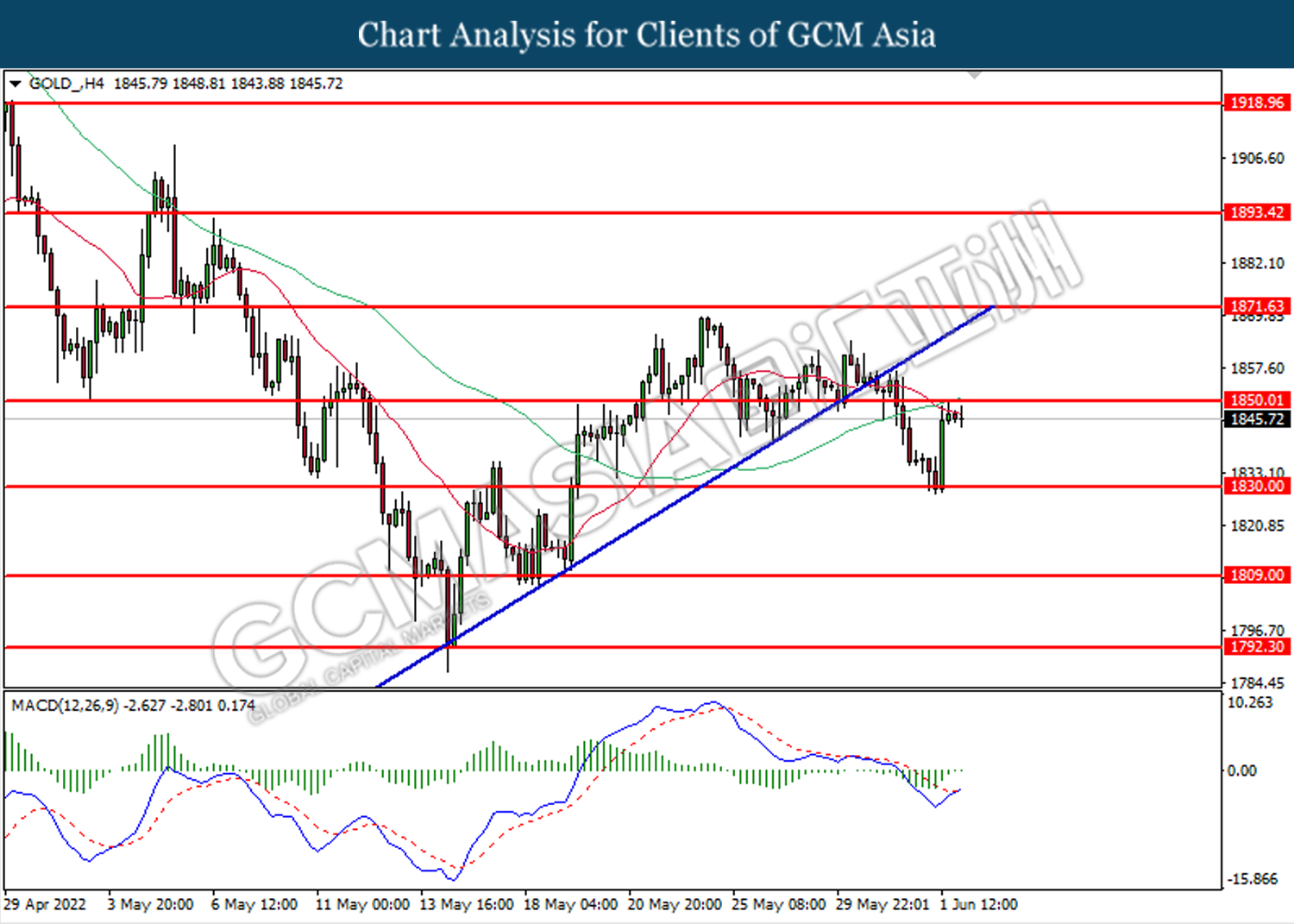

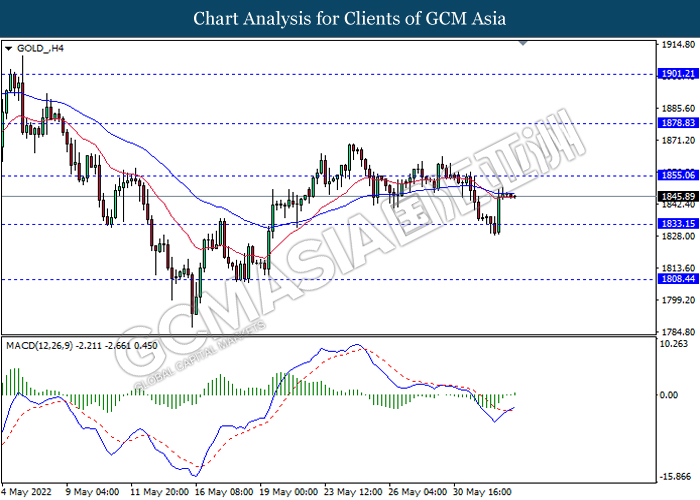

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1830.00. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1809.00.

Resistance level: 1830.00, 1850.00

Support level: 1809.00, 1792.30

130622 Afternoon Session Analysis

13 June 2022 Afternoon Session Analysis

Australian Dollar slumped as bullish US CPI data announced.

The AUSUSD was traded lower on Monday amid the backdrop of the strengthening of US Dollar. According to US Department of Labor, the The US Core Consumer Price Index (CPI) MoM for May came in at the reading of 0.6%, exceeding the economist forecast of 0.5%. It indicated that the inflation in US had rose by 8.6%, which reached its 41-years highs. It adding odds of aggressive rate hike from Federal Reserve in order to lower down the inflation risk. The implementation of tightening monetary policy would likely to increase risk-off return of investors, which sparked the appeal of the US Dollar. Besides, Australia Dollar remained its bearish trend over the Shanghai reintroduce lockdown in some cities after the rising Covid-19 cases. As Australia was the trading partner for China, the lockdown would likely to bring negative prospects toward economic progression in China while Australia would be affected directly. It prompted investors to shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, the AUDUSD depreciated by 0.60% to 0.7009.

In the commodities market, crude oil price slumped by 1.81% to $118.48 per barrel as of writing following the diminishing oil demand due to the lockdown in China. On the other hand, gold price eased by 0.60% to $1864.20 per troy ounce as of writing following the spike of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day AUD Queen’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.7% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM)(Apr) | -0.2% | 0.2% | – |

Technical Analysis

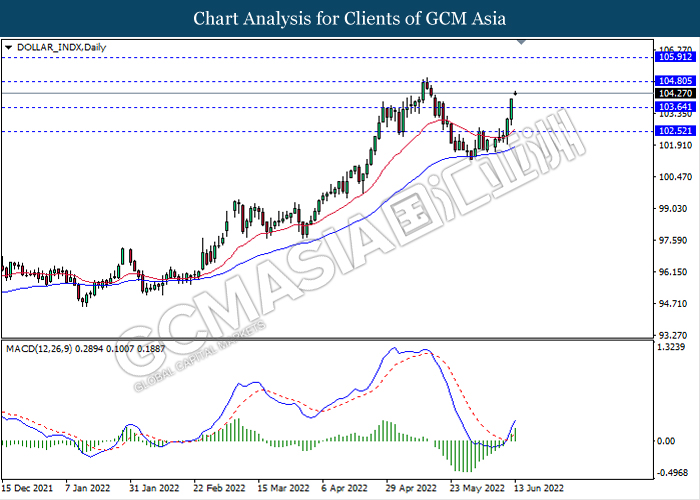

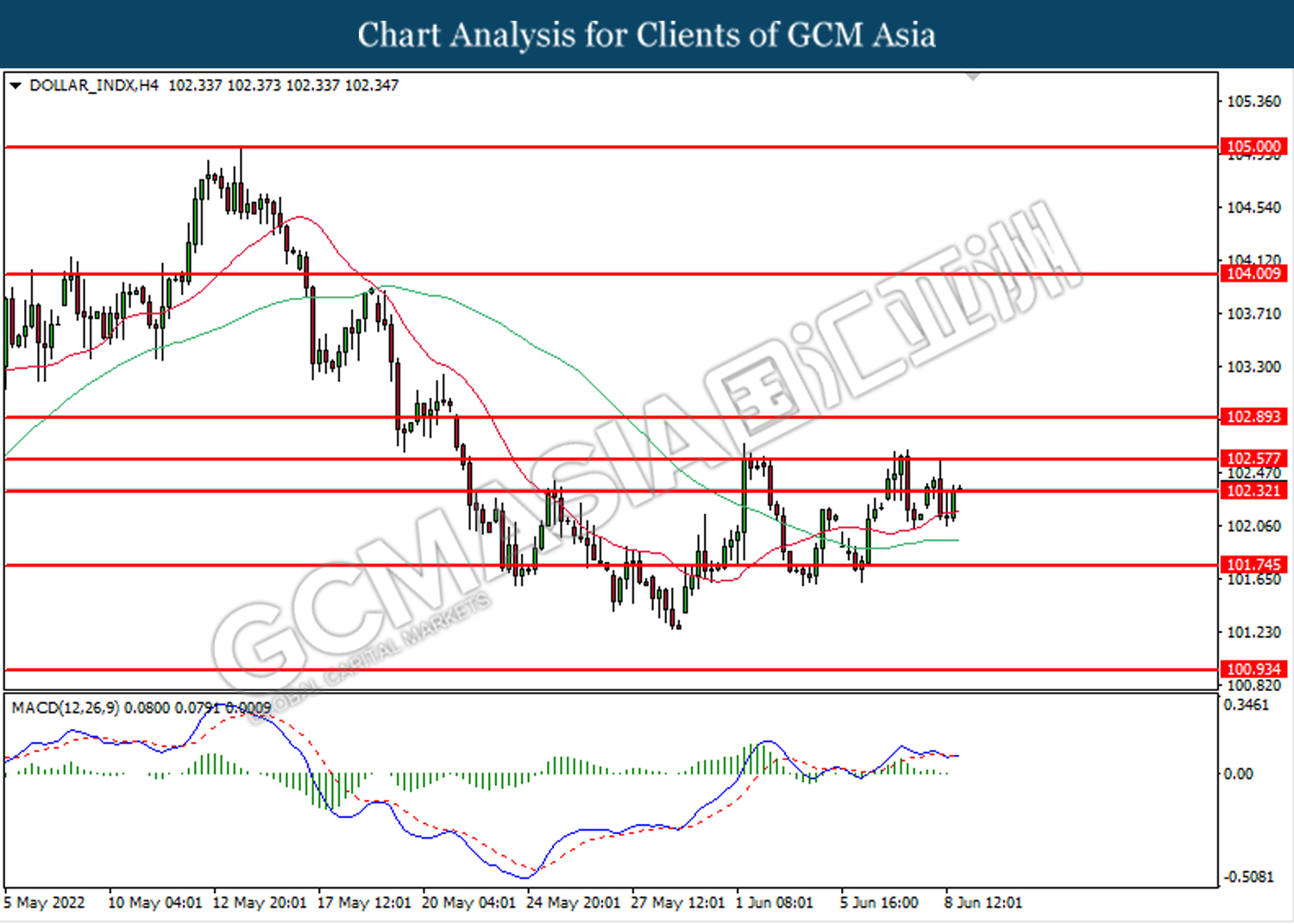

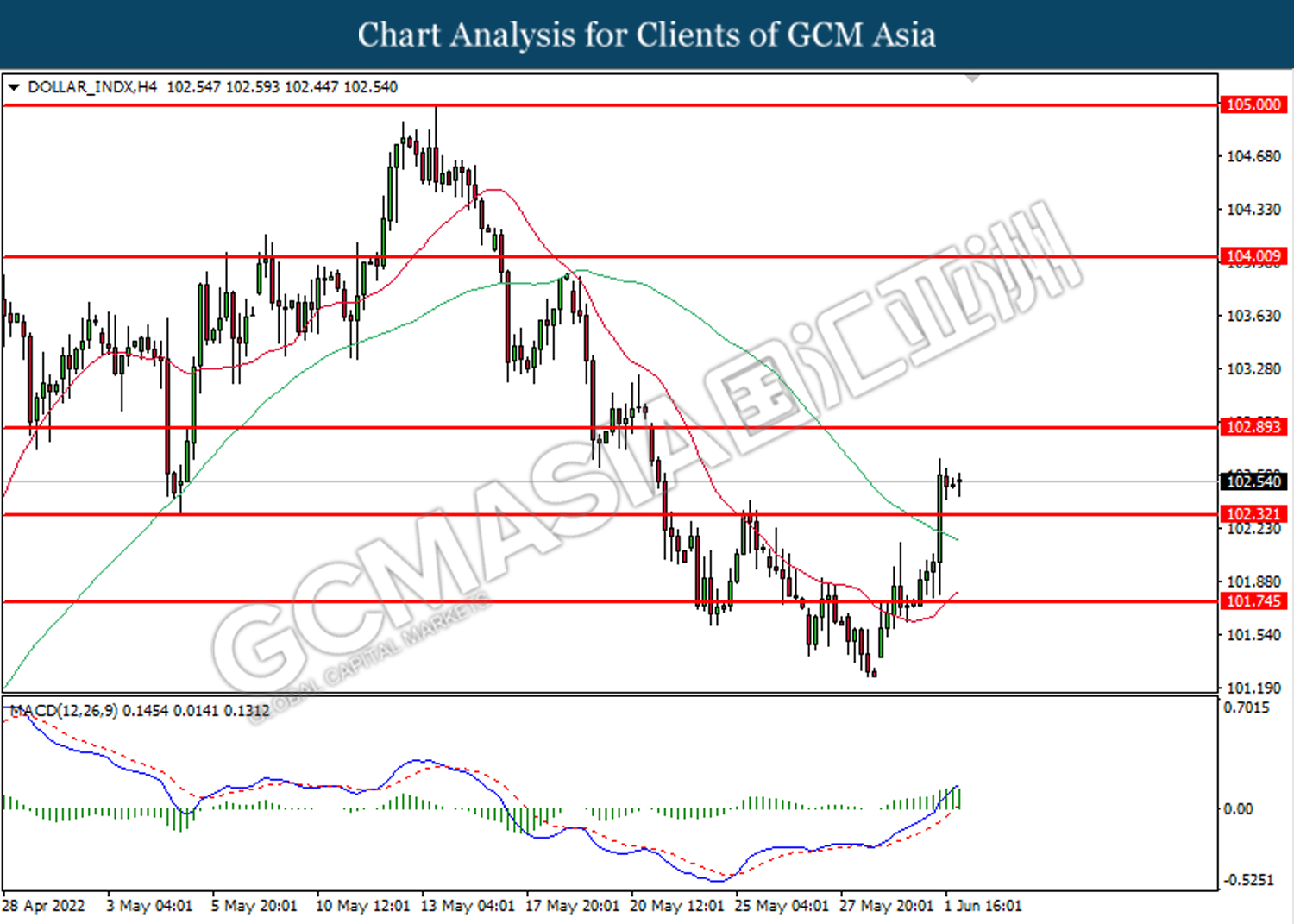

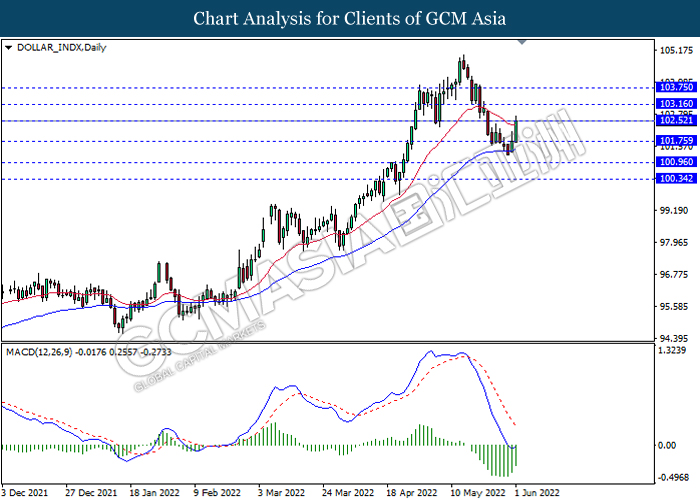

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

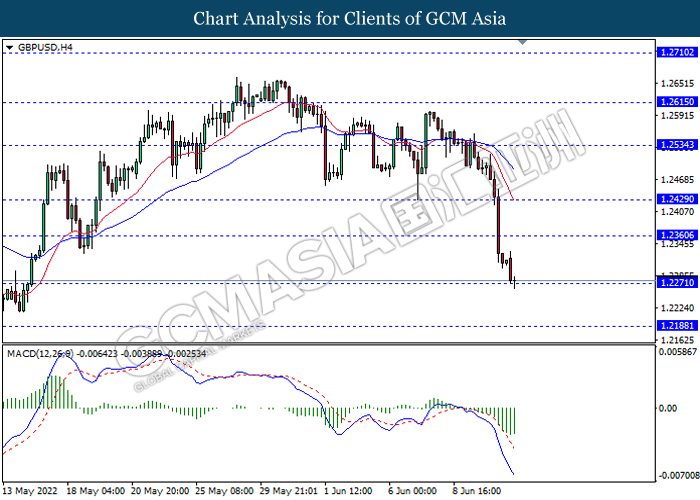

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2360, 1.2430

Support level: 1.2270, 1.2190

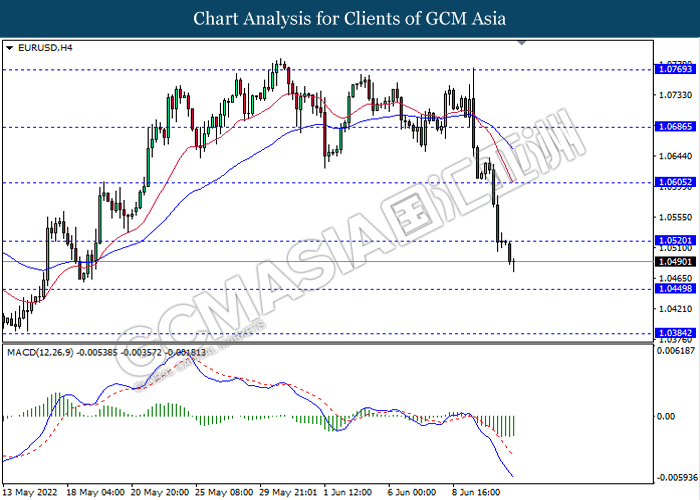

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0520, 1.0605

Support level: 1.0450, 1.0385

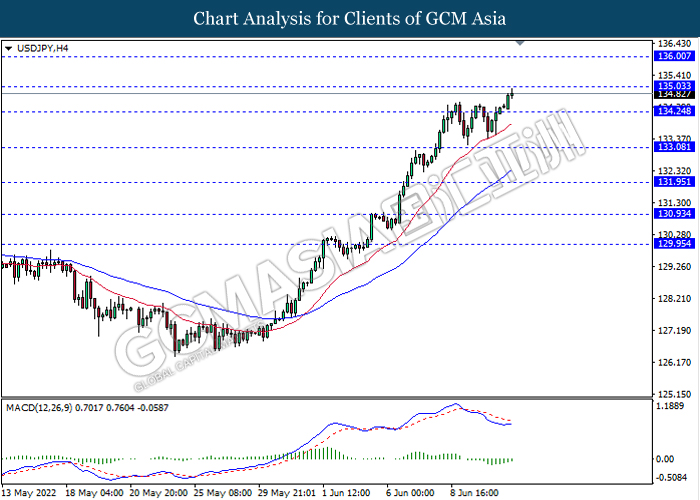

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 135.05, 136.00

Support level: 134.25, 133.10

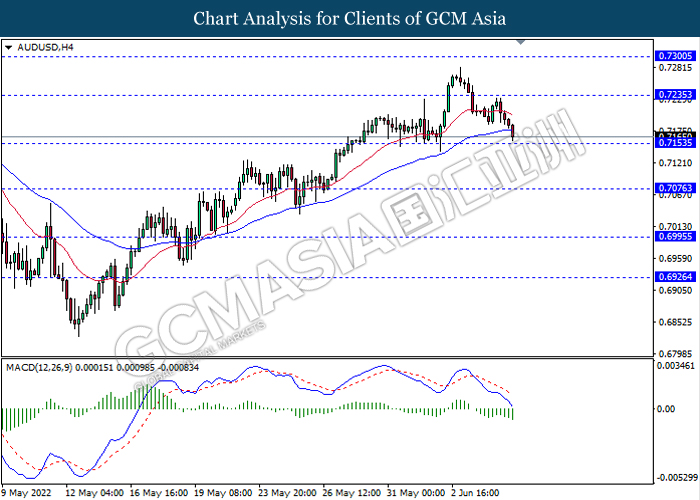

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7075, 0.7165

Support level: 0.7005, 0.6930

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6235

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2875, 1.3000

Support level: 1.2765, 1.2635

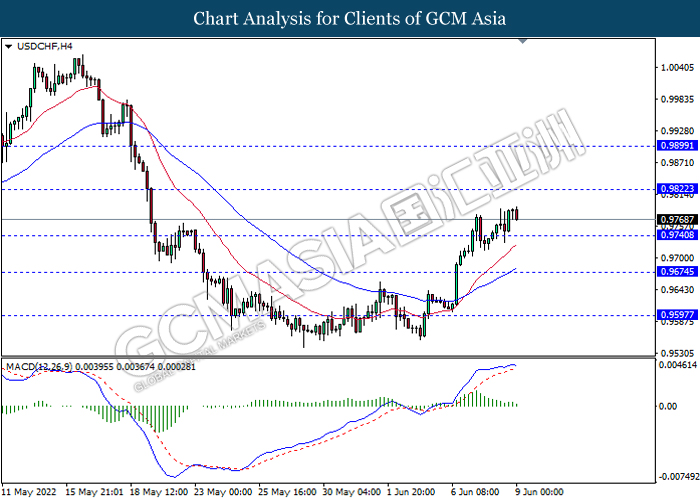

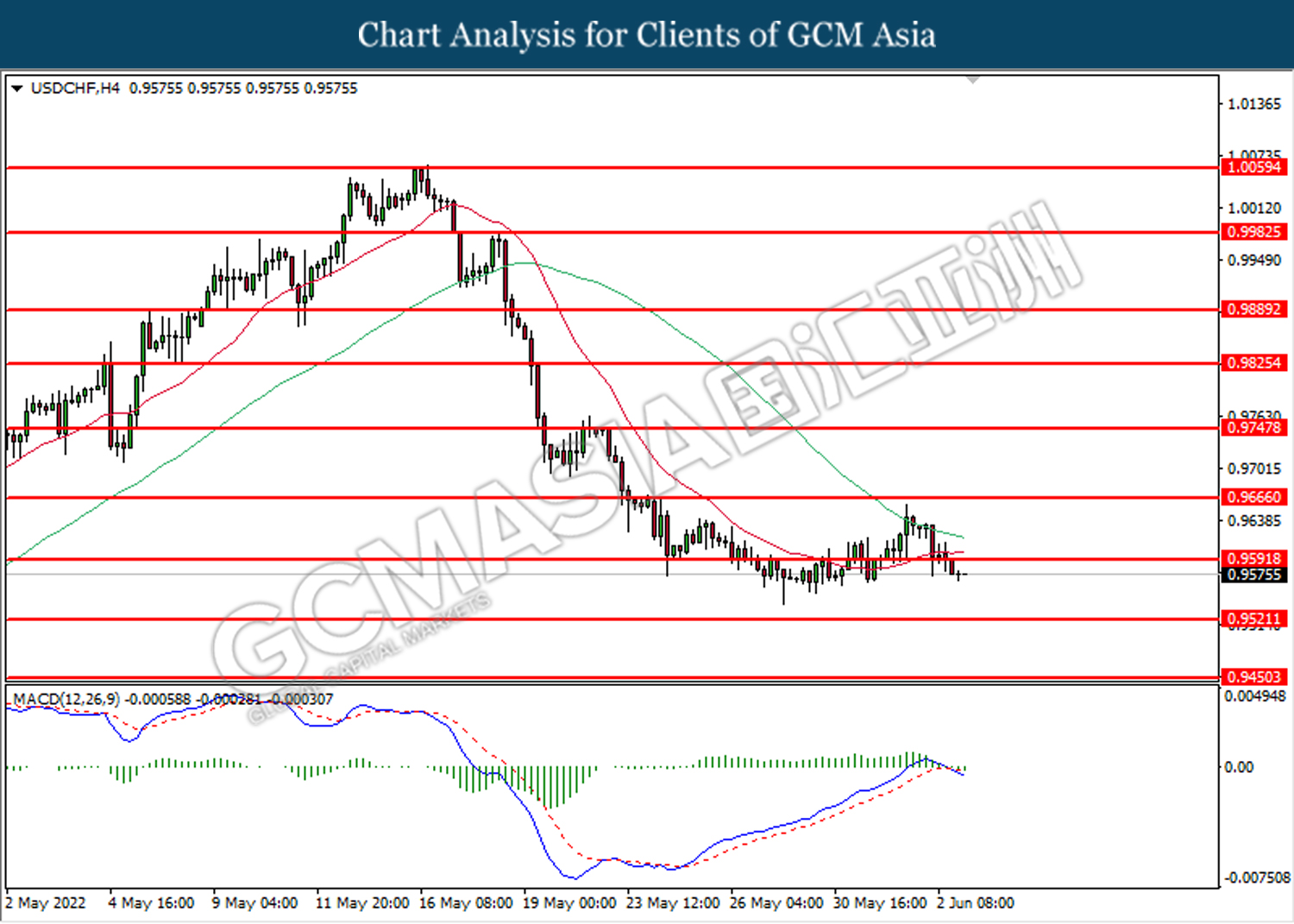

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 0.9960

Support level: 0.9820, 0.9740

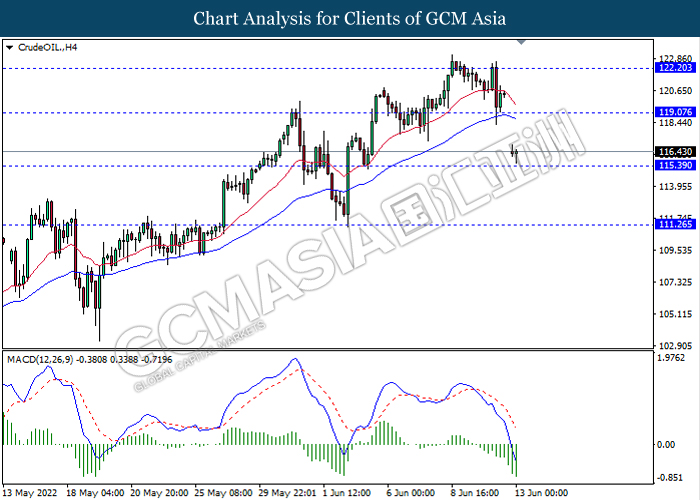

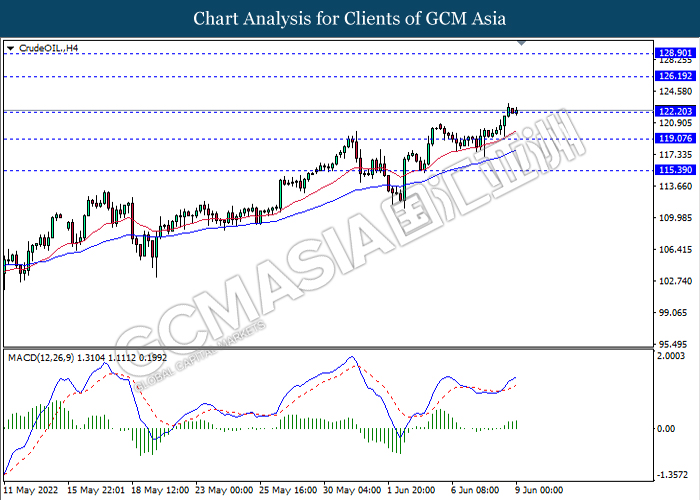

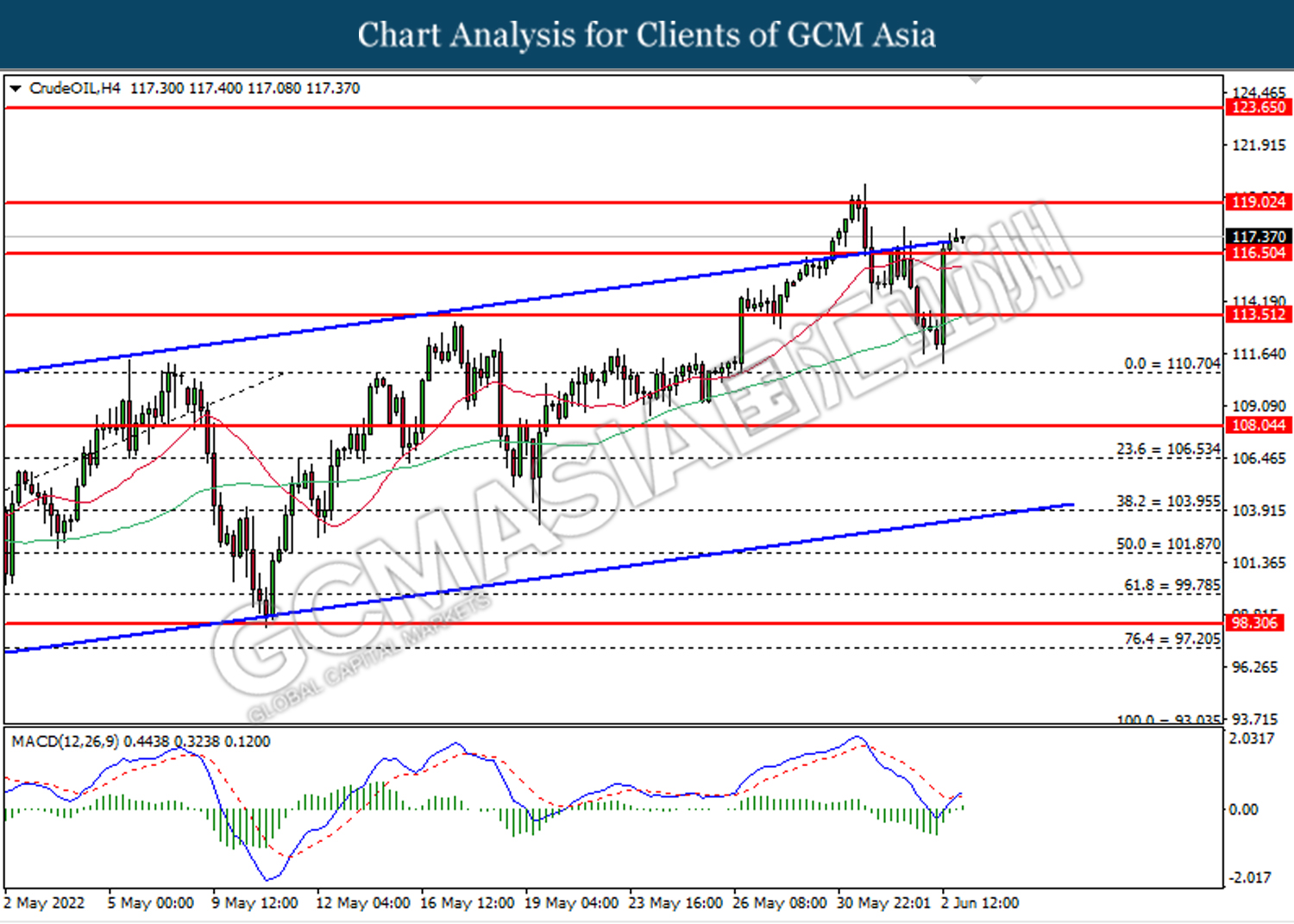

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 119.05, 122.20

Support level: 115.40, 111.25

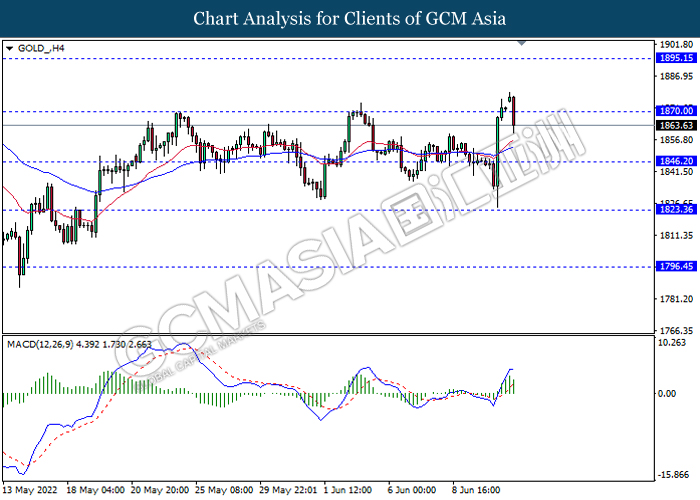

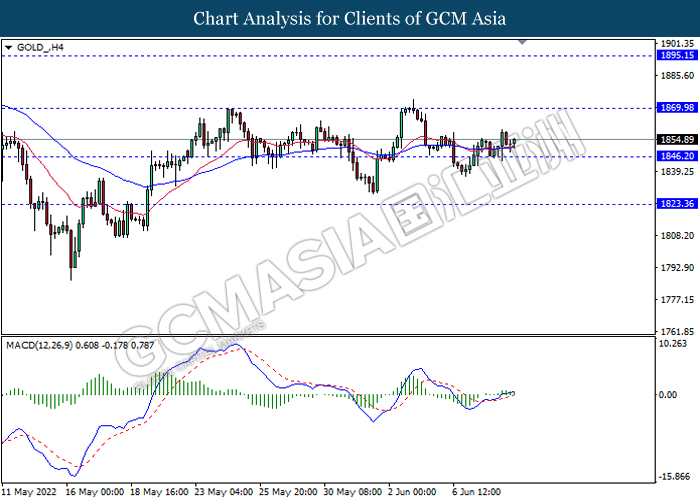

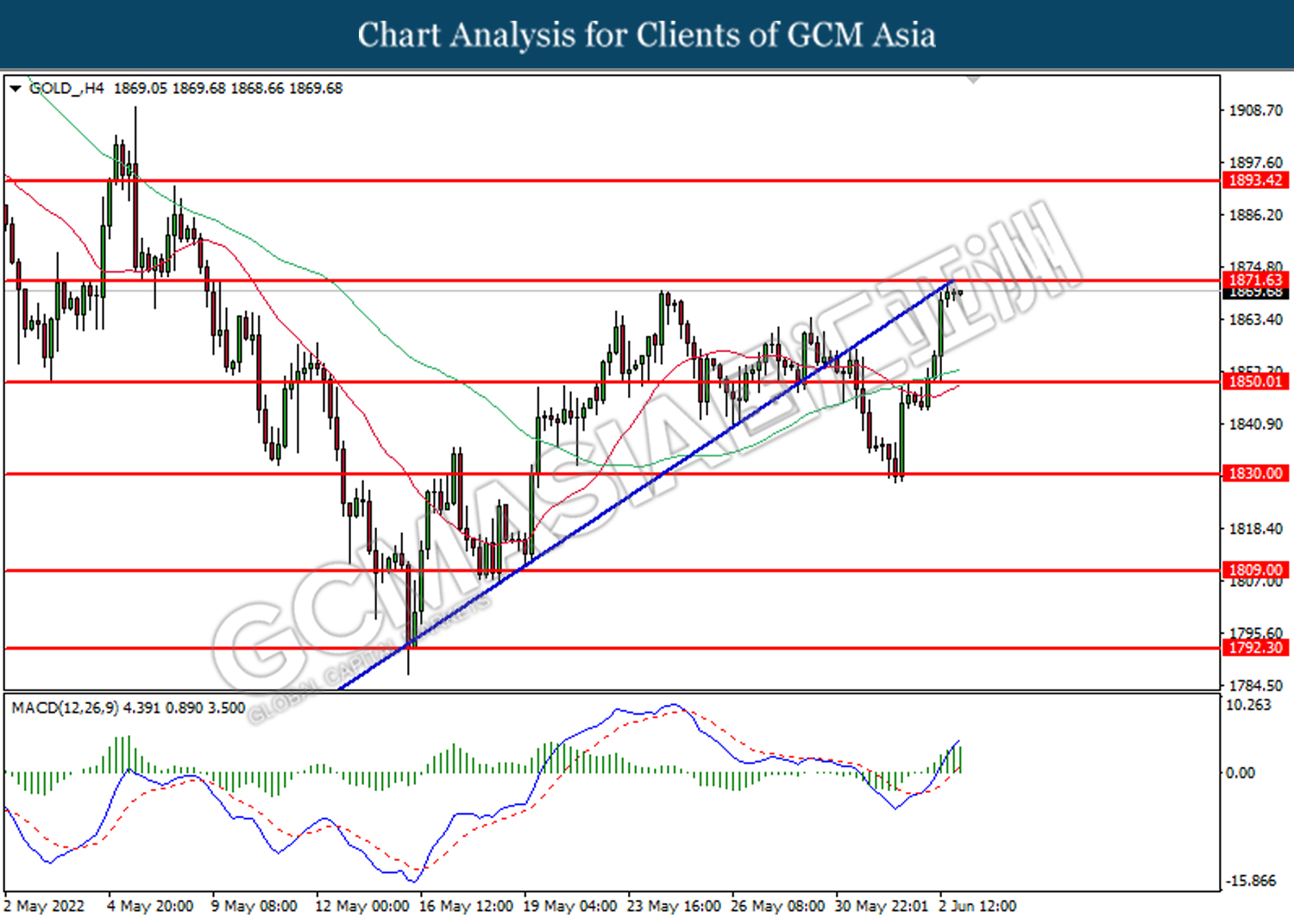

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend it losses.

Resistance level: 1870.00, 1895.15

Support level: 1846.20, 1823.35

130622 Morning Session Analysis

13 June 2022 Morning Session Analysis

Dollar skyrocketed as inflation accelerated.

The dollar index, which gauges its value against a basket of six major currencies jumped after US labor department released an upbeat inflation data. According to the Bureau of Labor Statistics, US Consumer Price Index (CPI) came in at 8.6% YoY, far higher than the economist forecast at 8.3% YoY, while US Core CPI was remained at 0.6% MoM, but still slightly above the 0.5% expectation of the economist. With that, the accelerated inflation figures have dented the hopes that inflation may have peaked and evoked investors fears that US economy is getting closer to a recession. Prior to that, investors recked on that inflation may have peaked, and thus, Federal Reserve would less likely to have a more aggressive rate hike in the future. Nevertheless, the May’s report likely solidifies the likelihood of multiple 50 basis point interest rate increases ahead, as Fed target was to calm down the inflationary pressures to the level of 2%. As of writing, the dollar index surged 0.15% to 104.30.

In the commodities market, crude oil prices were down by 1.51 % to $116.20 as strengthening of dollar index putting downward pressures on this black commodity price. Besides, gold prices were down 0.35% to $1875.80 per troy ounce despite the CPI data showed inflation accelerated further.

Today’s Holiday Market Close

Time Market Event

All Day AUD Queen’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.7% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM)(Apr) | -0.2% | 0.2% | – |

Technical Analysis

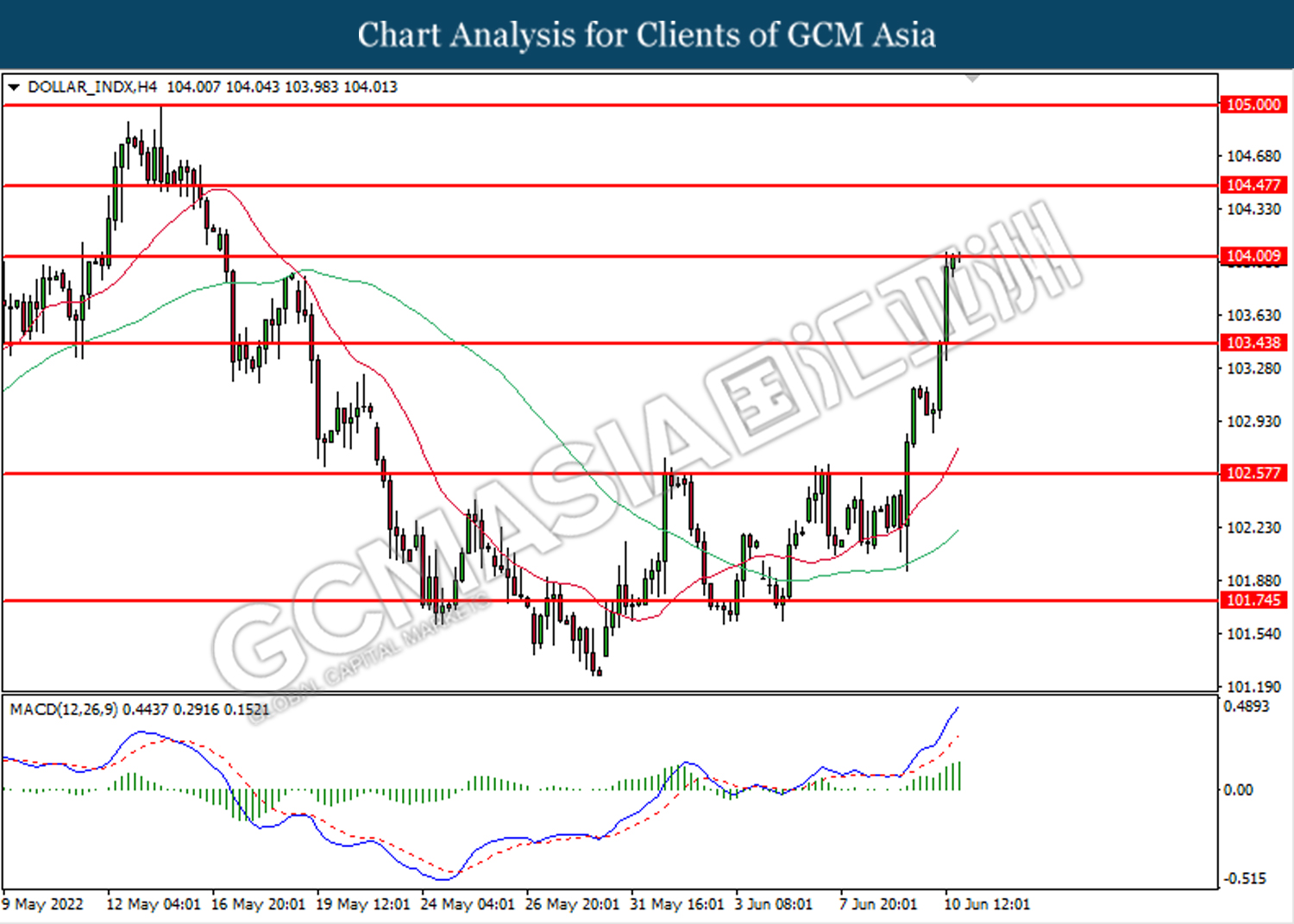

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 104.00. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 104.00, 104.45

Support level: 103.45, 102.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2325. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2235.

Resistance level: 1.2325, 1.2425

Support level: 1.2235, 1.2165

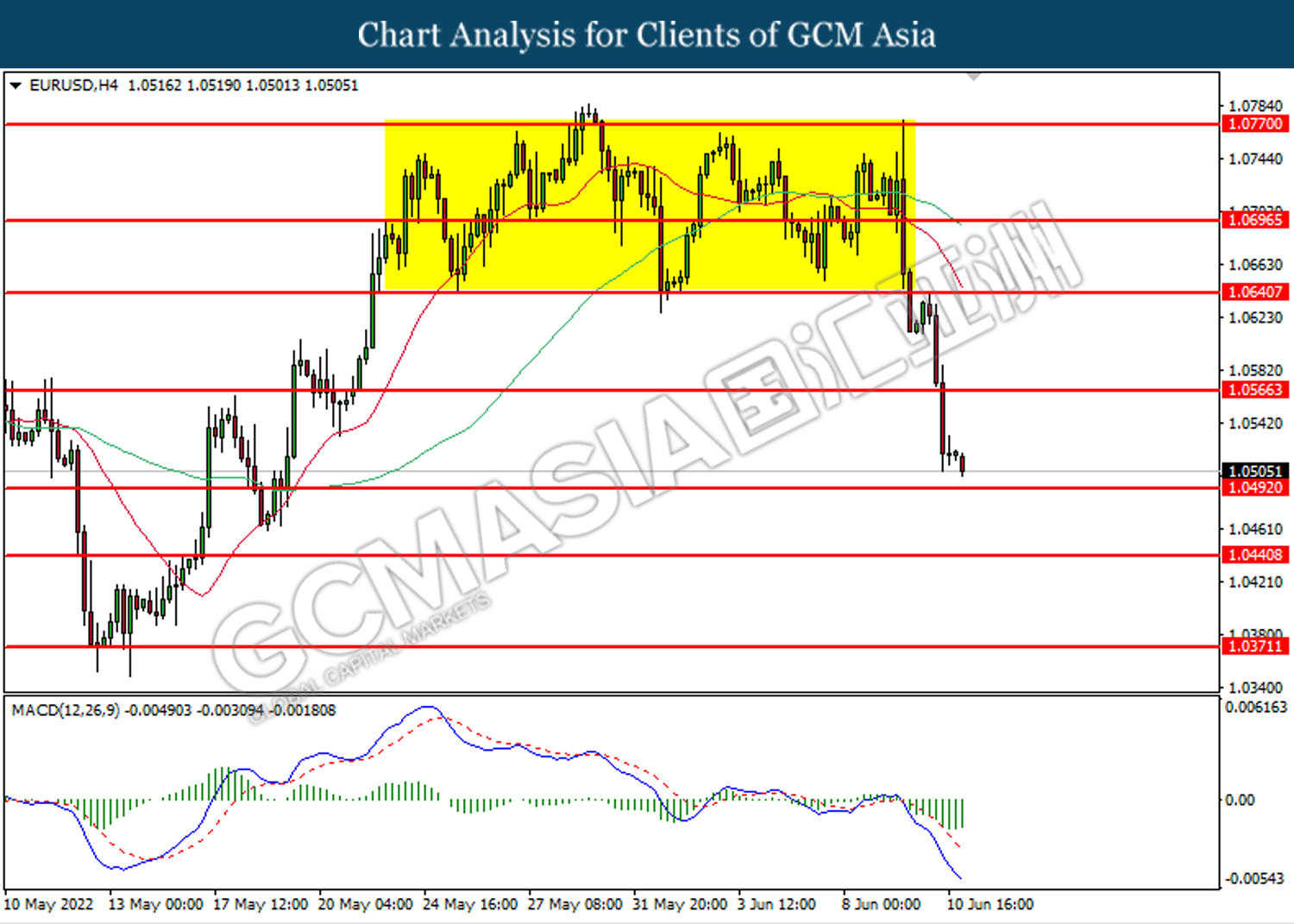

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.0565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0490.

Resistance level: 1.0565, 1.0640

Support level: 1.0490, 1.0440

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.75. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.7035. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.7120, 0.7260

Support level: 0.7035, 0.6955

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6365. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6285.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2775. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2835.

Resistance level: 1.2835, 1.2910

Support level: 1.2775, 1.2715

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9890. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9890, 0.9980

Support level: 0.9825, 0.9750

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 116.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 113.50.

Resistance level: 116.50, 119.00

Support level: 113.50, 110.70

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1871.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1893.40.

Resistance level: 1893.40, 1918.95

Support level: 1871.65, 1850.00

100622 Afternoon Session Analysis

10 June 2022 Afternoon Session Analysis

US Dollar rallied ahead of the unleash of CPI data.

The Dollar Index which traded against a basket of six major currencies surged on Thursday over the backdrop of Core CPI data which would release tonight. The US Core Consumer Price Index (CPI) MoM used to show the monthly change in price which paid by US consumer, excluding the price of food and energy. The moment of releasing data would likely to cause high volatility in the market, which cause investor to shift their capitals toward safe-haven Dollar temporarily from the riskier market in order to avoid any uncertainty risk. Besides, the Dollar Index extended its gains following the slump of Euro. According to CNBC, the ECB had lowered down its economic growth forecast, which revised down significantly to 2.8% in 2022 and 2.1% in 2023 respectively. As the comparison, the ECB’s forecast in March meeting was 3.7% in 2022 and 2.8% in 2023 respectively. It dialed down the market optimism toward economic progression in Europe region, leading investors to look for other currencies which having better prospects such as US Dollar. At this juncture, investors would continue to focus on the unleash of CPI data in order to receive further trading signals. As of writing, the Dollar Index appreciated by 0.02% to 103.22.

In the commodities market, crude oil price eased by 0.85% to $120.48 per barrel as of writing amid the fears over new COVID-19 lockdown measures in Shanghai. On the other hand, gold price depreciated by 0.30% to $1847.55 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 15.3K | 30.0K | – |

| 20:30 | USD – Core CPI (MoM)(May) | 0.6% | 0.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.15, 103.75

Support level: 102.50, 101.75

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0520

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7165, 0.7265

Support level: 0.7075, 0.7005

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6425, 0.6500

Support level: 0.6350, 0.6295

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 122.20, 126.20

Support level: 119.05, 115.40

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend it losses.

Resistance level: 1846.20, 1870.00

Support level: 1823.35, 1796.45

100622 Morning Session Analysis

10 June 2022 Morning Session Analysis

Euro slumped after ECB interest rate decision.

The Euro, which was widely traded by the global market participants slumped despite the European Central Bank (ECB) confirmed its intention to start its rate hike cycle at the policy meeting in July. Yesterday, the governing council of the ECB maintained the main refinancing operations, marginal lending facility and deposit facility as widely expected, which were 0.00%, 0.25% and -0.50%, respectively. Besides, ECB sent a message to the public that they intend to raise the key interest rates by 25 basis points at the July meeting, and a further hike could be possibly seen at the September meeting, but the increment scale would likely depend on the evolving trajectory of the inflation outlook. With that being said, the euro currency was still being threw off by the investors as ECB has downgraded its growth forecast significantly to 2.8% in 2022 and 2.1% in 2023, whereas the prior forecast at the ECB’s March meeting came in at 3.7% in 2022 and 2.8% in 2023. The revision of the growth forecast tampered with the sentiment in the euro market, dragging the Euro to the lowest level in 3 weeks’ time. As of writing, the pair of EUR/USD is down 0.02% to 1.0610.

In the commodities market, crude oil prices were down by 0.25% to $121.15 as of writing as several big cities in China imposed new lockdown restrictions, putting the China economy at the edge of the hill again. Besides, gold prices were down 0.08% to $1846.50 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 15.3K | 30.0K | – |

| 20:30 | USD – Core CPI (MoM)(May) | 0.6% | 0.5% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 102.90. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 103.45.

Resistance level: 103.45, 104.00

Support level: 102.90, 102.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2585. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2425.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.0640. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0565.

Resistance level: 1.0640, 1.0695

Support level: 1.0565, 1.0490

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 133.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.7120. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6430. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2655. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2715.

Resistance level: 1.2715, 1.2775

Support level: 1.2655, 1.2590

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9825. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction toward the support level at 0.9750.

Resistance level: 0.9825, 0.9890

Support level: 0.9750, 0.9665

CrudeOIL, H4: Crude oil price was traded lower following prior retracement near the resistance level at 123.65. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses in short term toward the support level at 119.00.

Resistance level: 123.65, 128.20

Support level: 119.00, 116.50

GOLD_, H4: Gold price was traded lower while currently testing the upward trendline. Due to lack of signal from MACD, it is suggested to wait for further confirmation such as breakout below the trendline happened before entering into the market.

Resistance level: 1850.00, 1871.65

Support level: 1830.00, 1809.00

090622 Afternoon Session Analysis

9 June 2022 Afternoon Session Analysis

US 10-year Treasury yield rose, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies spiked since Wednesday amid the backdrop of rising risk-off sentiment, which spurred bullish momentum on the safe-haven Dollar. According to CNBC, the US 10-year Treasury yields rose since yesterday to 3.055%. The rising of treasury yields would likely to increase the risk-free return of investors, which sparkling the appeal of US Dollar. It had also prompted investors to shift their capitals from stock markets to US Dollar, leading US stock market to slump. Besides, the Dollar Index extended its gains over the Bank of Japan (BoJ) remained its dovish tone. According to Reuters, the Bank of Japan remains one of the few global central banks to maintain a dovish stance while others have adopted tightening policies of hiking interest rates to combat inflation. It would likely to stoke a shift market sentiment toward other currencies which having better prospects such as US Dollar, as BoJ continue to remain its loosing monetary policy would drag down the risk-off return of investors in Japan. As of writing, the Dollar Index appreciated by 0.08% to 102.62.

In the commodities market, crude oil price edged up by 0.01% to $122.12 per barrel as of writing over the positive data on U.S. gasoline consumption set aside fears of demand destruction from record high fuel prices. On the other hand, gold price depreciated by 0.14% to $1853.90 per troy ounce as of writing following the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:45 EUR ECB Monetary Policy Statement

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Jun) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Jun) | 0.00% | 0.00% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 210K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7265, 0.7355

Support level: 0.7165, 0.7075

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6500, 0.6560

Support level: 0.6425, 0.6350

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 126.20, 128.90

Support level: 122.20, 119.05

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1870.00, 1895.15

Support level: 1846.20, 1823.35

090622 Morning Session Analysis

9 June 2022 Morning Session Analysis

Euro spiked ahead of ECB interest rate decision.

The Euro, which was widely traded by the global market participants jumped ahead of a European Central Bank (ECB) policy announcement. At this juncture, ECB is expected to maintain its interest rate at current level, while expressing a hawkish stance with interest rate hikes to begin in July. Investors reckon that the rate hike cycle in Eurozone would start in July, and there will be a 75 basis point of hikes by the month of September. With that, any message that does not signal an openness to a rate hike would likely fall short of the market’s hawkish expectations and push euro to a lower level. Shifting to the economic data, a series of upbeat data has shown that inflation remains at an elevated level, and it even hit a record high in May. High inflationary pressures across the Eurozone shows that it is necessary for ECB to increase their interest rate in order to cool down the overheating economy. As of writing, the pair of EUR/USD up 0.04% to 1.0720.

In the commodities market, crude oil prices down by 0.05% to $123.15 as of writing as U.S. demand for gasoline keeps rising despite some stockpiles were being found in the recent EIA inventories data. Besides, gold prices up 0.04% to $1853.90 per troy ounce while dollar lingered above the level of 102.00.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:45 EUR ECB Monetary Policy Statement

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Jun) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Jun) | 0.00% | 0.00% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 210K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 102.30. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 102.30, 102.55

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2585. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2425.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0695. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0860

Support level: 1.0695, 1.0640

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 133.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7260. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the lower level.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6430. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2515. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2655

Support level: 1.2515, 1.2455

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9750. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after its candle successfully closed above the resistance level.

Resistance level: 0.9750, 0.9825

Support level: 0.9665, 0.9590

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 119.00. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 123.65

Resistance level: 123.65, 128.20

Support level: 119.00, 116.50

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1850.00. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1871.65.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00

080622 Afternoon Session Analysis

8 June 2022 Afternoon Session Analysis

Dollar rebound amid risk-off sentiment heightened.

Dollar index, which gauges its value against a basket of six major currencies, jumped as market risk-off sentiment recovered ahead of the major inflationary data which assumed to be announced on Friday. As of now, Investors are awaiting the US Core CPI data this week for further cues on the economy as central banks worldwide seek to cool surging prices. The inflation data is in the spotlight now as it could provide further implication on US interest rate, where an extremely high reading might indicate Federal Reserve will have aggressive or more rate hike going forward and vice versa. Prior to now, Federal Reserve members did mention that there is likely to have a pause of rate adjustment after two times of 50 basis point rate hike. At this juncture, market participants are paying their attention over the upcoming crucial economic data to gauge the further direction of the dollar index. As of writing, the dollar index rose 0.30% to 102.65.

In the commodities market, crude oil prices up by 0.31% to $120.65 per barrel as EIA adjusted the global oil demand forecast upward, while stated that the current oil inventories level is at a very low level. Besides, gold prices dropped -0.18% to $1849.30 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (May) | 58.2 | 56.6 | – |

| 22:30 | USD – Crude Oil Inventories | -5.068M | -1.800M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 102.45, 103.50

Support level: 101.25, 99.75

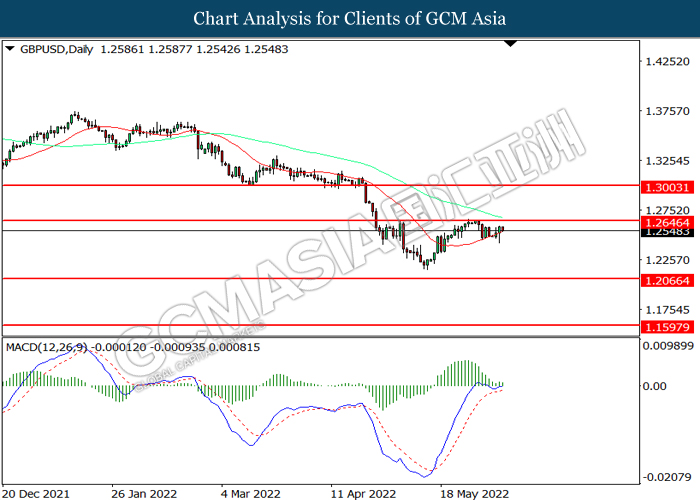

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2645, 1.3005

Support level: 1.2065, 1.1595

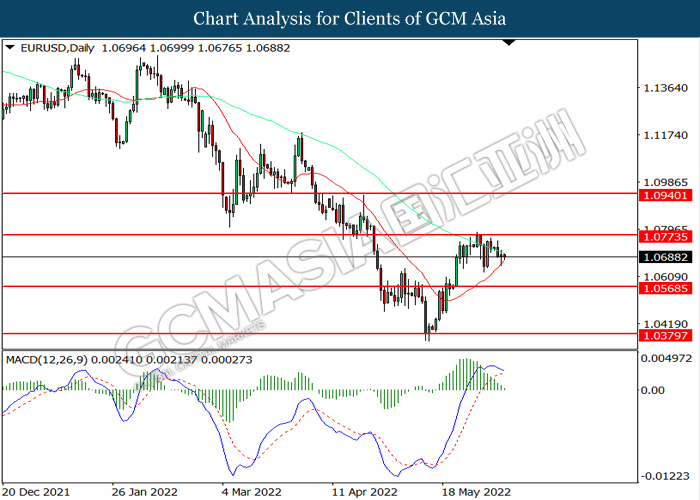

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0775, 1.0940

Support level: 1.570, 1.0380

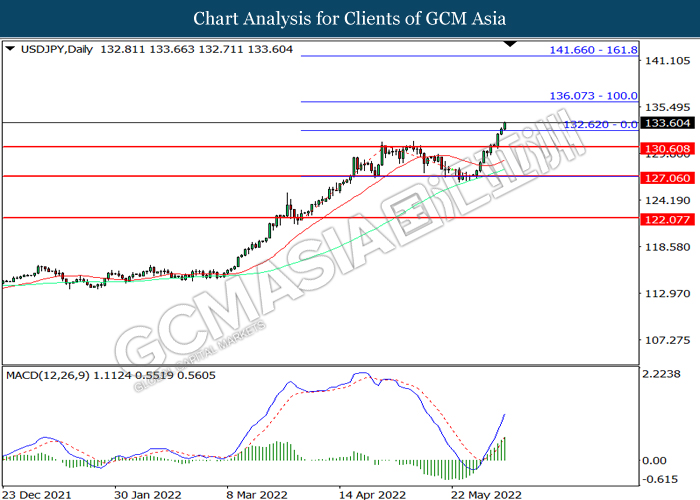

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 136.05, 141.65

Support level: 132.60, 130.60

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7275, 0.7455

Support level: 0.7115, 0.7000

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6535, 0.6690

Support level: 0.6385, 0.6240

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2660, 1.2755

Support level: 1.2545, 1.2460

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9765, 0.9895

Support level: 0.9640, 0.9555

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 120.60, 125.50

Support level: 116.15, 111.75

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1854.65, 1870.20

Support level: 1838.75, 1829.10

080622 Morning Session Analysis

8 June 2022 Morning Session Analysis

Pound rallied after bullish economic data was released.

The GBPUSD rebounded from its recent low on Tuesday amid the backdrop of upbeat economic data. According to Markit Economics, the UK Composite Purchasing Managers’ Index (PMI) for May came in at the reading of 53.1, which higher than the market forecast of 51.8. Besides, the UK Services Purchasing Managers Index (PMI) for May recorded at the reading of 53.4, exceeding the market forecast of 51.8, according to The Chartered Institute of Purchase & Supply and the NTC Economics. Both data were used as the indicator for measuring the activity level of economy sector. The higher-than-expected reading showed that the recovery of economy activities, which brought positive prospects toward the economic progression in UK region. Furthermore, the Pound extended its gains over the slump of US Dollar. According to Reuters, market participants were expecting that the inflation risk may reach its peak, which decreased the odds of rate hike from Federal Reserve to slow down the inflation. It dragged down the appeal of US Dollar, and prompted investors to shift their capital toward other currencies which having better prospects such as Pound. As of writing, GBPUSD edged up by 0.02% to 1.2590.

In the commodities market, crude oil price depreciated by 0.04% to $119.36 per barrel as of writing following the US API Weekly Crude Oil Stock surged over the market forecast. On the other hand, gold price appreciated by 0.13% to $1854.55 per troy ounces as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (May) | 58.2 | 56.6 | – |

| 22:30 | USD – Crude Oil Inventories | -5.068M | -1.800M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 133.10, 134.25

Support level: 131.95, 130.95

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7265, 0.7355

Support level: 0.7165, 0.7075

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6500, 0.6560

Support level: 0.6425, 0.6350

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9820, 0.9740

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 120.35, 125.50

Support level: 114.30, 107.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1895.15, 1870.00

Support level: 1846.20, 1823.35

070622 Afternoon Session Analysis

7 June 2022 Afternoon Session Analysis

Euro beaten down by downbeat economic data.

The EURUSD slumped since yesterday over the bearish economic data was released. According to Eurostat, Eurozone Retail Sales MoM for April notched down from the previous reading of 0.3% to -1.3%. The Eurozone Retail Sales MoM was used as an indicator to present the consumer spending in Europe region. While the lower-than-expected data showed that the diminishing of consumer spending, it had brought negative prospect toward economic progression in Europe region. Besides, the Euro extended its losses following the upbeat Nonfarm Payrolls data. The US Nonfarm Payrolls for May came in at the reading of 390K, which higher than the market expectation of 325K. As the number of people employed had increased, it had dialed up the market optimism toward the economic momentum in US, which prompted investors to shift their capitals into US Dollar. As of writing, EURUSD eased by 0.16% to 1.0676.

In the commodities market, crude oil price appreciated by 0.66% to $119.27 per barrel as of writing amid the expected demand recovery in China as it relaxed tough COVID curbs. On the other hand, gold price depreciated by 0.07% to $1842.45 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (May) | 51.8 | 51.8 | – |

| 16:30 | GBP – Services PMI (May) | 51.8 | 51.8 | – |

| 22:00 | CAD – Ivey PMI (May) | 66.3 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0520

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 133.10, 134.25

Support level: 131.95, 130.95

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6500, 0.6560

Support level: 0.6425, 0.6350

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 122.00, 125.85

Support level: 119.00, 115.95

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45

070622 Morning Session Analysis

7 June 2022 Morning Session Analysis

US Dollar seesawed ahead of crucial monetary policy event and CPI data.

The Dollar Index which traded against a basket of six major currencies was still trading within a range amid mixed economic data on last Friday while investors continue to eye on the latest Federal Reserve’s monetary policy announcement to receive trading signal. On the economic data front, the Bureau of Labor Statistics announced that the US Nonfarm Payrolls came in at 390K, exceeding the market forecast at 325K while adding odds for the Federal Reserve to implement contractionary monetary policy to stabilize the inflation rate. Meanwhile, the unemployment rate came in at 3.6%, missing the economist forecast at 3.5%. On the other hand, US ISM Non-Manufacturing Purchasing Managers Index (PMI) notched down significantly from the previous reading of 57.1 to 55.9, missing the market forecast at 56.4. As for now, investors would continue to scrutinize the US consumer price index (CPI) data which would be released on Friday for more clues about the monetary policies. The Dollar Index appreciated by 0.23% to 102.41 as of writing.

In the commodities market, the crude oil price depreciated by 0.46% to $118.70 per barrel as of writing following the Organization of the Petroleum Exporting Countries and allies (OPEC+) boost output for July and August by 648,000 barrel per day, 50% higher than previously planned. On the other hand, the gold price slumped 0.03% to $1841.00 per troy ounces as of writing amid rate hike expectation from Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (May) | 51.8 | 51.8 | – |

| 16:30 | GBP – Services PMI (May) | 51.8 | 51.8 | – |

| 22:00 | CAD – Ivey PMI (May) | 66.3 | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2620, 1.2765

Support level: 1.2670, 1.2335

EURUSD, H4: EURUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0785, 1.0925

Support level: 1.0645, 1.0550

USDJPY, H4: USDJPY was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 132.65, 134.55

Support level: 131.05, 129.10

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7260, 0.7345

Support level: 0.7115, 0.6995

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2735

Support level: 1.2490, 1.2380

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9745, 0.9970

Support level: 0.9590, 0.9375

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 118.90, 124.00

Support level: 115.10, 112.70

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1844.15, 1870.00

Support level: 1828.15, 1812.90

030622 Afternoon Session Analysis

3 June 2022 Afternoon Session Analysis

Australia Dollar spiked following the hawkish tone from RBA.

AUDUSD surged since yesterday amid the backdrop of the rate hike decision from the Australia’s central bank. According to Reuters, Australia’s central bank will raise rates by a modest 25 basis points for a second straight meeting in June to bring down soaring inflation. With the economy recovering smartly from the pandemic and inflation at a 20-year high of 5.1%, well above a 2-3% target range, the Reserve Bank of Australia (RBA) has only recently changed its tune on the need to raise interest rates. The rate hike decision from the RBA would likely to increase the risk-free return of the investors, which sparkling the appeal of the Australia Dollar. Besides, AUDUSD extended its gains following the China tariff reviews from the US officials. Deputy US Trade Representative Sarah Bianchi appeared a speech on Thursday, which said that the Biden administration is considering “all options” as it reviews potential changes to U.S. duties on Chinese imports, including tariff relief and new trade investigations in a shift of focus to strategic concerns with Beijing. The reducing tariffs would likely to boost up the international transaction of China, which brought the positive prospects toward Australia’s economic progression, as China was one of the largest trading partner for Australia, which dialed up the market optimism toward Australia Dollar. As of writing, AUDUSD edged down by 0.09% to 0.7258.

In the commodities market, crude oil price depreciated by 0.24% to $116.59 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish ahead of US Crude Oil Inventories fell more than market forecast, which is -5.068M lesser than -1.350M. On the other hand, gold price appreciated by 0.01% to $1871.50 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

All Day CNY China – Dragon Boat Festival

All Day HKD Hong Kong – Dragon Boat Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (May) | 428K | 325K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.6% | 3.5% | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (May) | 57.1 | 56.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 101.75, 102.50

Support level: 100.95, 100.35

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 129.95, 130.95

Support level: 129.05, 128.00

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7300, 0.7365

Support level: 0.7235, 0.7155

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6595, 0.6675

Support level: 0.6500, 0.6425

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 119.00, 122.00

Support level: 115.95, 113.10

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1878.85, 1901.20

Support level: 1855.05, 1833.15

030622 Afternoon Session Analysis

3 June 2022 Morning Session Analysis

Decelerating pace of job creation tampered the sentiment in the US dollar market.

The dollar index which gauges its value against a basket of six major currencies slumped after the recent job data showed an unexpectedly weak data. According to the Automatic Data Processing (ADP), the private sector employment rose by just 128,000 for the month, missing both the economist forecast of 300,000 and the prior month reading of 202,000. With that, it showed that the job creation at companies decelerated in a relatively quicker speed, the worst condition since the recovery of the pandemic-era. In fact, the significant decline in the May’s reading was mainly attributed to the fears of a broader economic pullback. The Inflation not only in the US, but around the world, running at its highest level in at least more than a decade, the ongoing war in Ukraine and a Covid-induced shutdown in China, have generated fears that the U.S. could be on the brink of recession. Following the release of the job data, the market sentiment of dollar index turned sourer, where a tremendous sell-off pressures were being noticed throughout the overnight trading session. As of writing, dollar index dropped -0.73% to 101.75.

In the commodities market, crude oil prices up by 0.30% to $118.25 per barrel as US Crude Inventories data fell more than expected, despite a boost of crude output from OPEC+. Besides, gold prices down -0.04% to $1869.35 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

All Day CNY China – Dragon Boat Festival

All Day HKD Hong Kong – Dragon Boat Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (May) | 428K | 325K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.6% | 3.5% | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (May) | 57.1 | 56.4 | – |

Technical Analysis

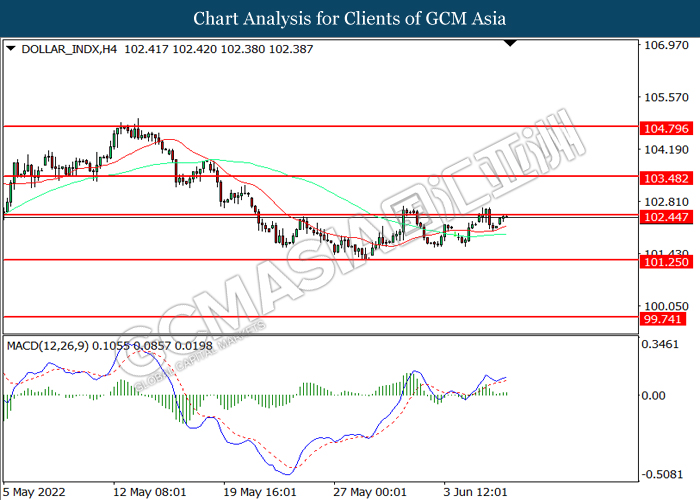

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 101.75. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 100.95.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2585. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0695. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0860

Support level: 1.0695, 1.0640

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 128.80. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 131.35, 133.15

Support level: 128.80, 126.95

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7260. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6545. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle closed below the support level.

Resistance level: 1.2655, 1.2715

Support level: 1.2590, 1.2515

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9520.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 116.50. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 119.00.

Resistance level: 119.00, 123.65

Support level: 116.50, 113.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1871.65. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00

020622 Afternoon Session Analysis

2 June 2022 Afternoon Session Analysis

Canadian dollar lingered near the ‘ceiling’ following the BoC interest rate decision.

The Canadian dollar, which widely traded by the global investors, hovered near the high level after Bank of Canada increased its interest rate by 50 basis points to 1.50%, as widely expected. Besides, BoC also revealed that the board of members agreed to maintain their tightening policy going forward. Based on the BoC conference, Canadian economic activity is strong and the inflation persisting well above target. On top of that, the inflationary pressures are expected to move higher in near term, where it justified the interest rate will need to rise further. Nonetheless, the bank reiterated that they are still sticking to their commitment, where the inflation should hover near the target of 2%. However, the losses of USD/CAD were limited by the rebound of dollar index. The dollar index managed to regain the upward momentum following the spike in 10-Year US Treasury Yield. As of writing, the pair of USD/CAD rose 0.13% to 1.2670.

In the commodities market, crude oil prices down by -1.64% to $114.00 per barrel ahead of the OPEC meeting as the market uncertainty heightened. Besides, gold prices retraced -0.05% to $1845.30 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 280K | – |

| 20:30 | USD – Initial Jobless Claims | 210K | 210K | – |

| 23:00 | USD – Crude Oil Inventories | -1.019M | -0.737M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher after it successfully breakout above the previous resistance level at 102.30. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 102.90.

Resistance level: 102.90, 104.00

Support level: 102.30, 101.75

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.2585. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2425.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0640. MACD which illustrated bearish bias momentum suggest the losses after it successfully breakout below the support level.

Resistance level: 1.0695, 1.0770

Support level: 1.0640, 1.0565

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 128.80. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 131.35, 133.15

Support level: 128.80, 126.95

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6545. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6430.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2655. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2715.

Resistance level: 1.2715, 1.2775

Support level: 1.2655, 1.2590

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9665.

Resistance level: 0.9665, 0.9745

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 113.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 110.70.

Resistance level: 113.50, 116.50

Support level: 110.70, 108.05

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1850.00. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1850.00, 1871.65

Support level: 1830.00, 1809.00

020622 Morning Session Analysis

2 June 2022 Morning Session Analysis

Inflation hover in the market, US Dollar spiked.

The Dollar Index which traded against a basket of six major currencies surged since yesterday amid the backdrop of soaring inflation risk keep hovering in the market. According to Reuters, the US Deputy Secretary of the Treasury Wally Adeyemo appeared a speech on Wednesday, which claimed that the high inflation is being driven by global phenomena that could not be anticipated, including Russia’s invasion of Ukraine and the lockdown of China. Both situation had led to the global supply chain disruption, which causing the commodities price to spike such as crude oil. Nonetheless, President Joe Biden told Fed Chair Jerome Powell on Tuesday that he will give sufficient space and independence for the Federal Reserve to stabilize the inflation rate, which increased the odds of rate hike from the Fed in the upcoming FOMC meetings, sparkling the appeal of the US Dollar. Besides, investors were prompted to shift their capitals toward safe-haven assets such as US Dollar in order to protect their capitals away from inflation. As of writing, the Dollar Index appreciated by 0.80% to 102.58.

In the commodities market, crude oil price slumped by 1.53% to $113.51 per barrel as of writing. However, the overall trend for oil price remained bullish as EU agreed to phase in Russian oil ban. On the other hand, gold price edged up by 0.06% to $1850.05 per troy ounce as of writing following the risk-off sentiment toward safe-haven assets.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 280K | – |

| 20:30 | USD – Initial Jobless Claims | 210K | 210K | – |

| 23:00 | USD – Crude Oil Inventories | -1.019M | -0.737M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0520

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 130.95, 131.95

Support level: 129.95, 129.05

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6500, 0.6595

Support level: 0.6425, 0.6350

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45