010622 Afternoon Session Analysis

1 June 2022 Afternoon Session Analysis

Euro dived following the release of the economic data.

The Euro retreated from higher level yesterday following the released of bearish economic data. According to Destatis, the Germany Unemployment Change came in at only -4K, missing the market forecast at -16K. Such negative economic data had dialed down the market optimism toward the economic progression in Europe countries, diminishing the demand on Euro. Nonetheless, the losses experienced by the Euro was limited amid the rate hike expectation from ECB continue to linger in the European bond market following spiking number of inflation data was released. The Eurozone inflation soared to a new record high in the year to May, spurring further pressure on the European Central Bank to speed up the pace of its contractionary monetary policy in future. The Eurozone Consumer Price Index (CPI) notched up significantly from the previous reading of 7.4% to 8.1%, much higher than the economist forecast at 7.7%. The data prompted a significant fall in eurozone bond markets, as investors increased their bets on how much the ECB will raise its interest rate by this year. Italy’s 10-year government bond yield rose by 0.11% to 3.11% on Tuesday. As of writing, the pair of EUR/USD dropped -0.11% to 1.0720.

In the commodities market, crude oil prices down by 0.24% to $116.20 per barrel as OPEC plans to rule out Russia from the oil production plan. Besides, gold prices slumped -0.02% to $1837.40 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (May) | 54.7 | 54.7 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 54.6 | 54.6 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 300K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 55.4 | 54.5 | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 11.549M | 11.400M | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.00% | 1.50% | – |

Technical Analysis

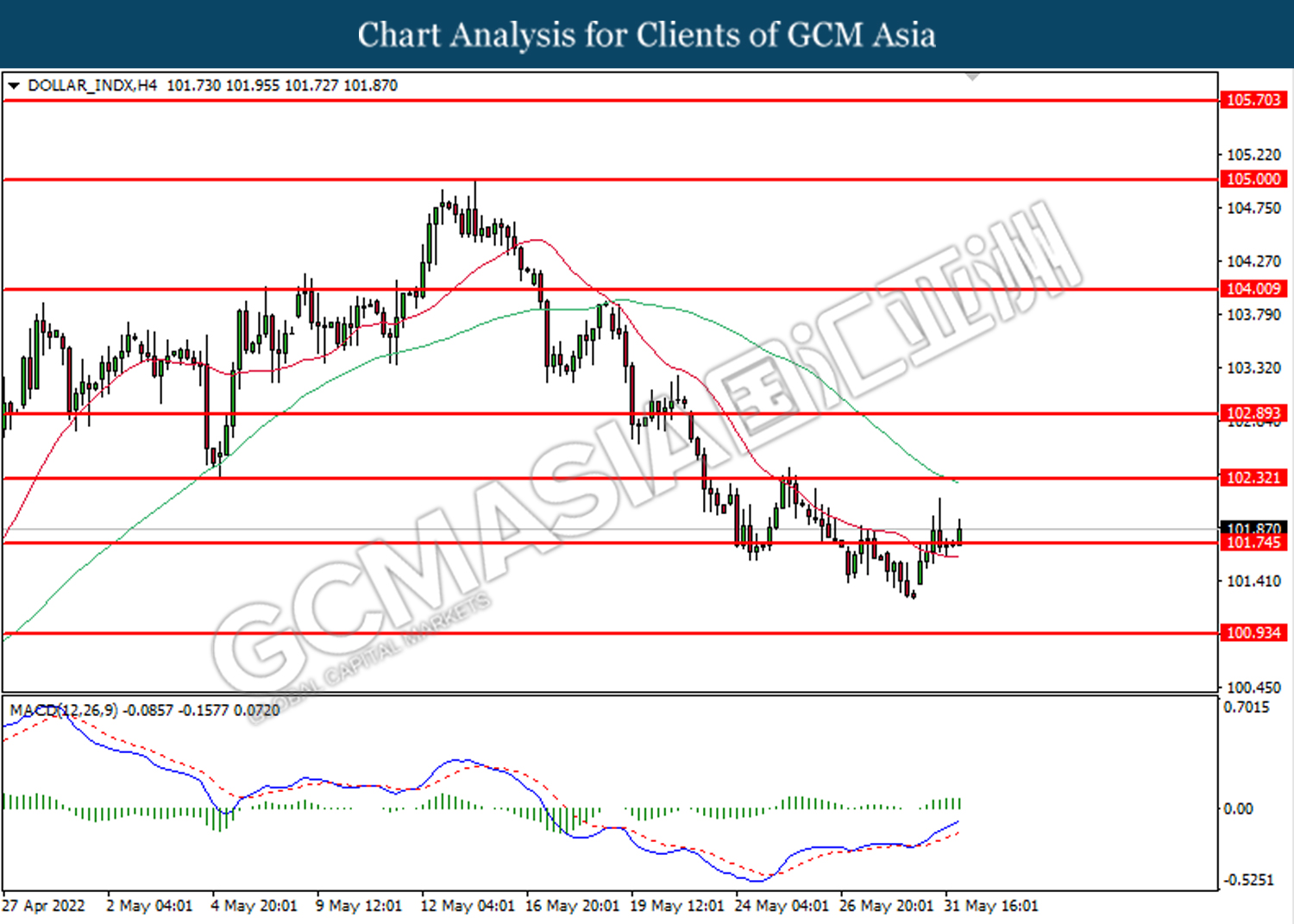

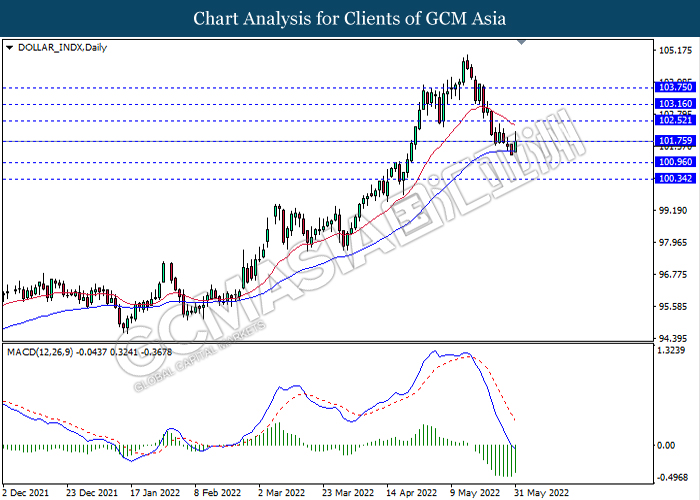

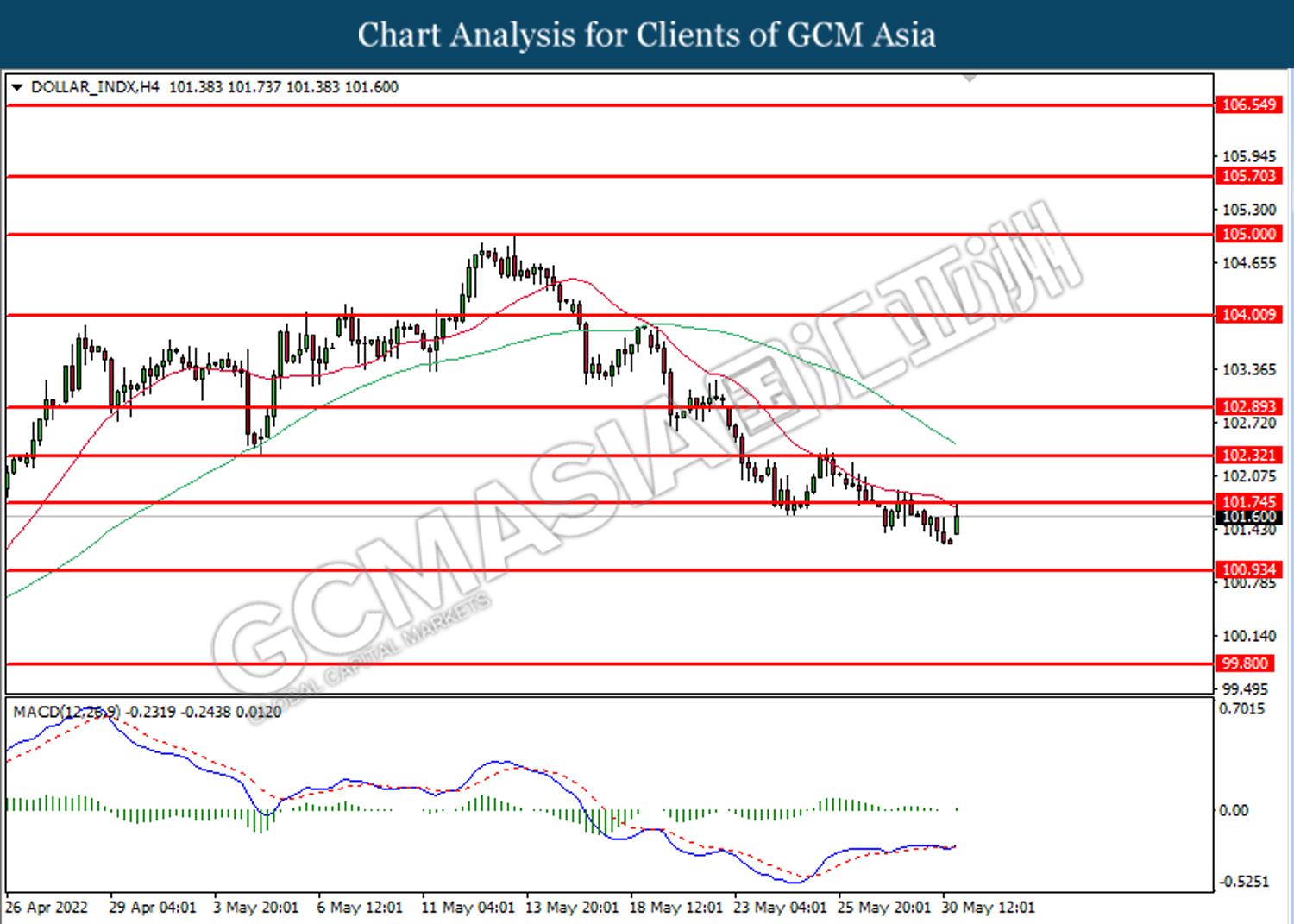

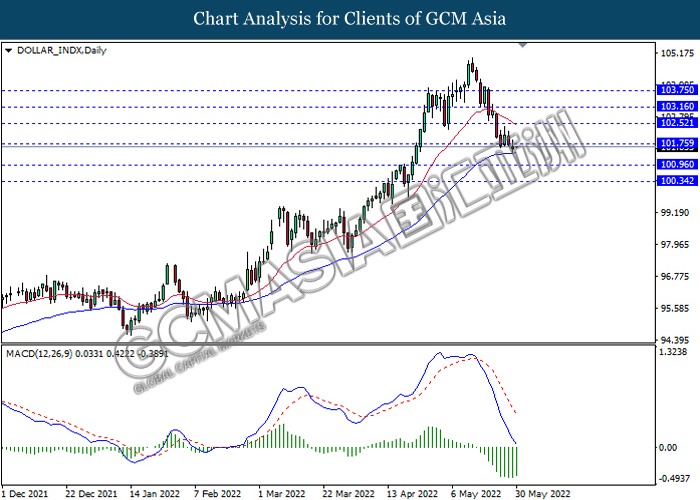

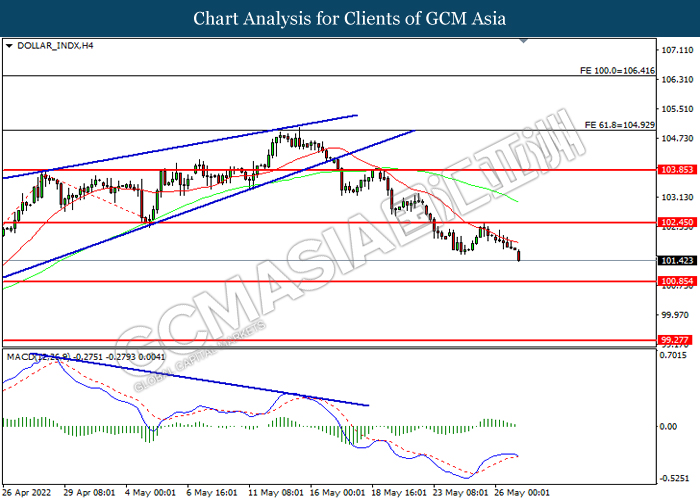

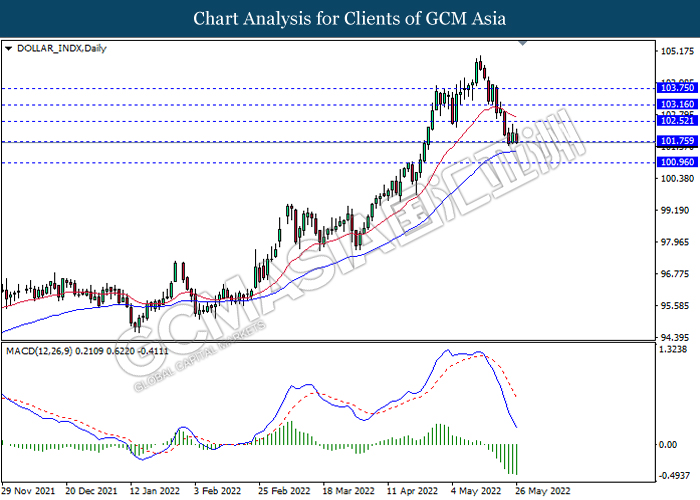

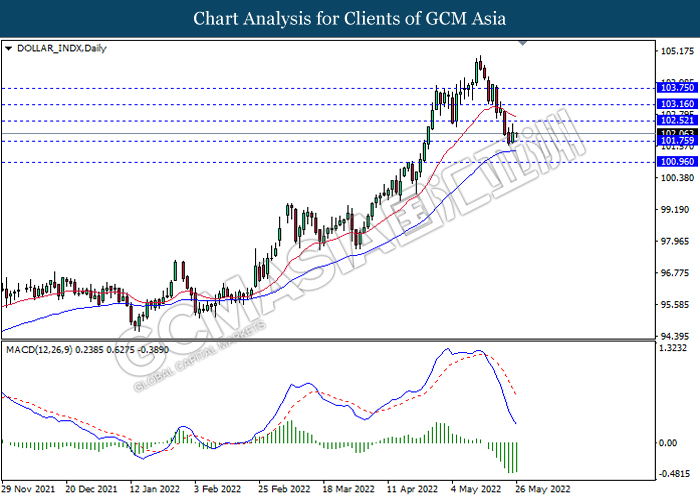

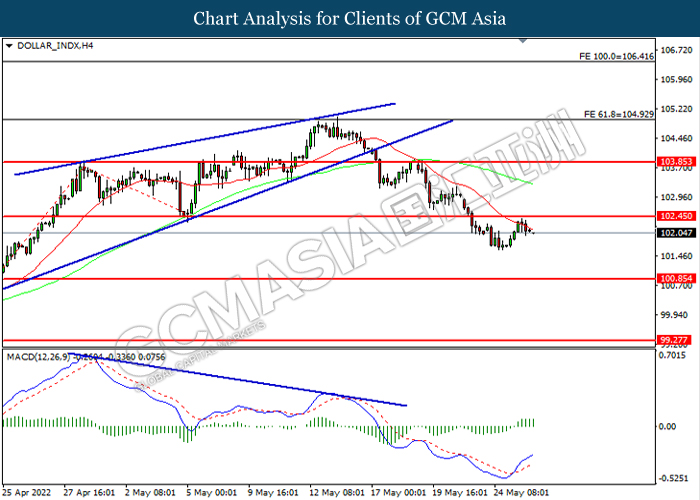

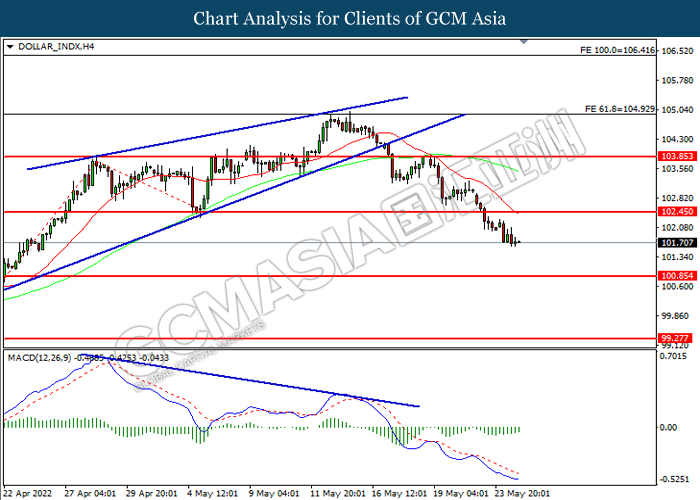

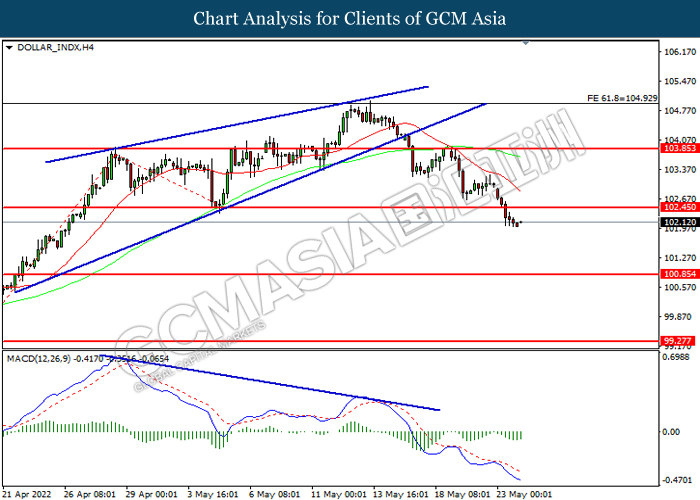

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

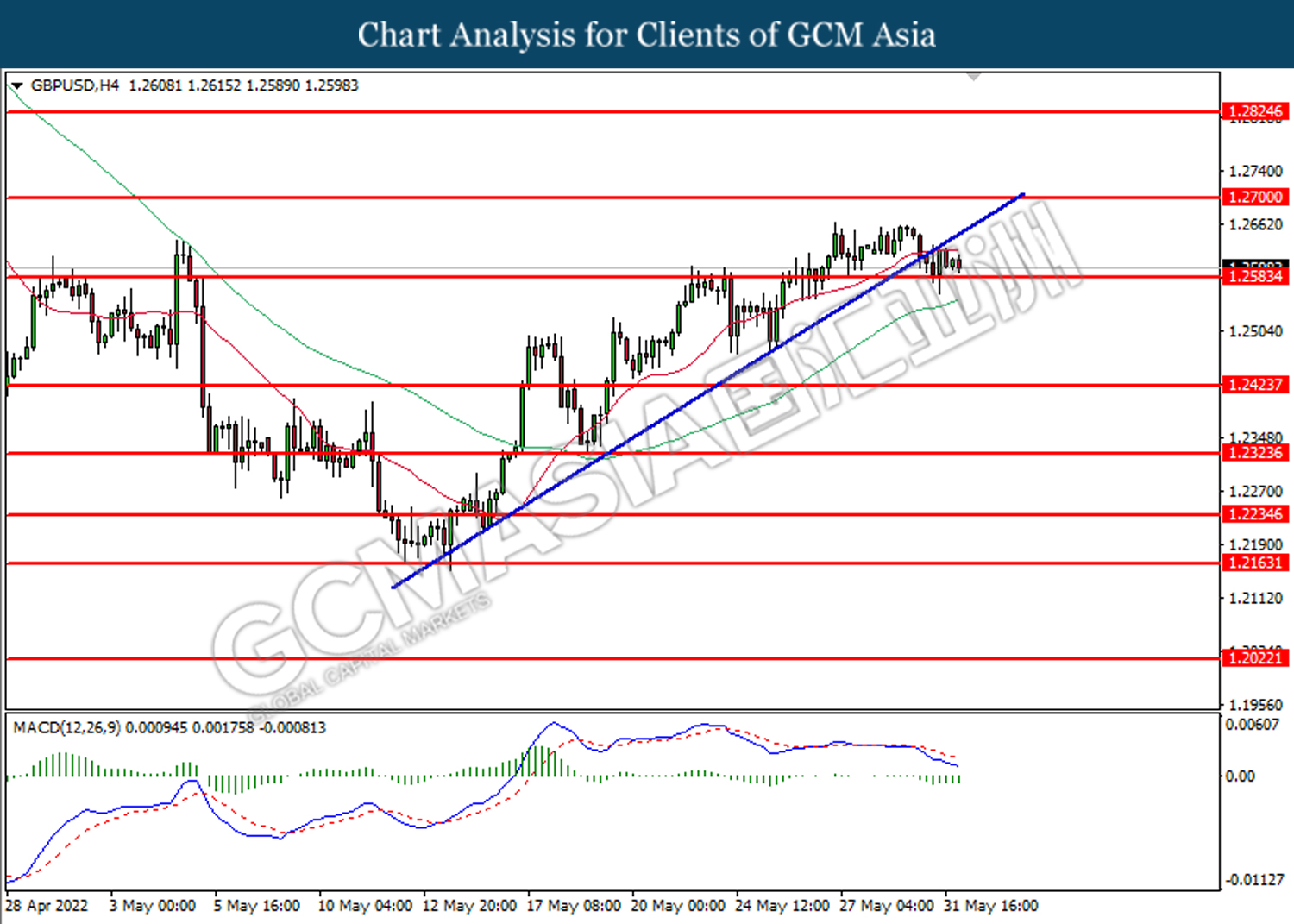

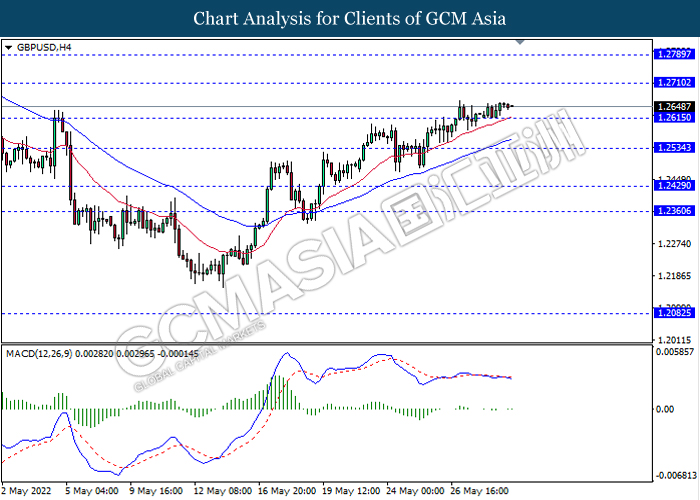

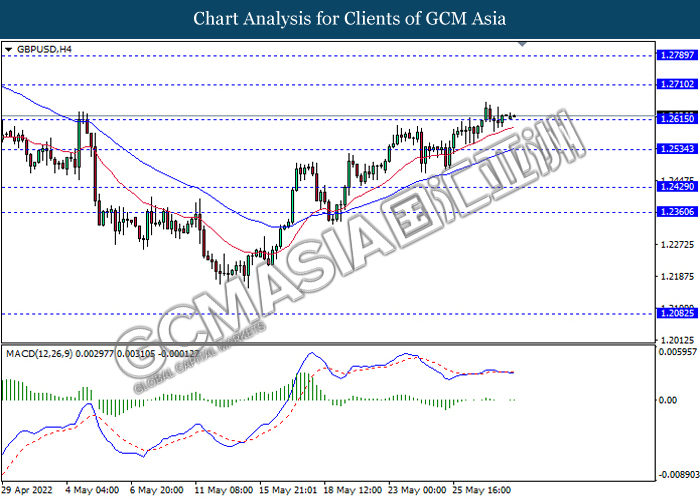

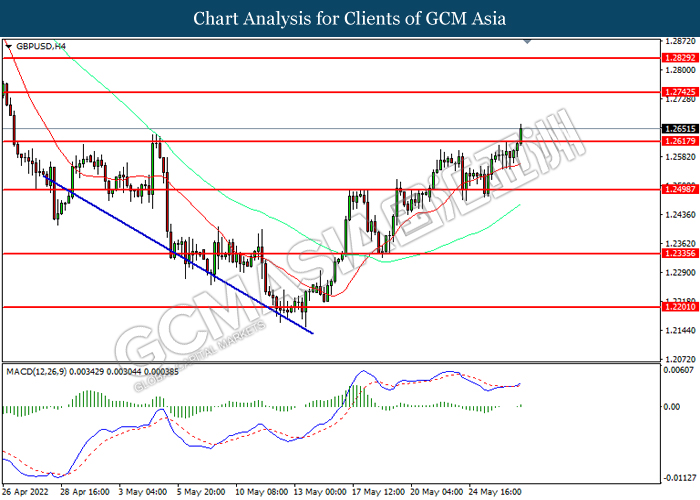

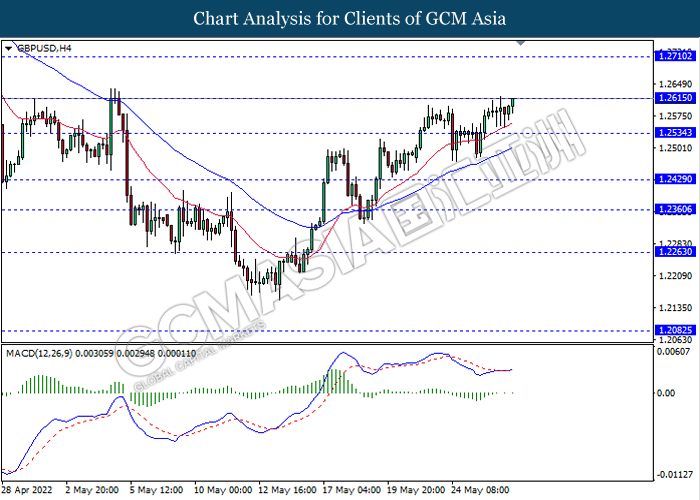

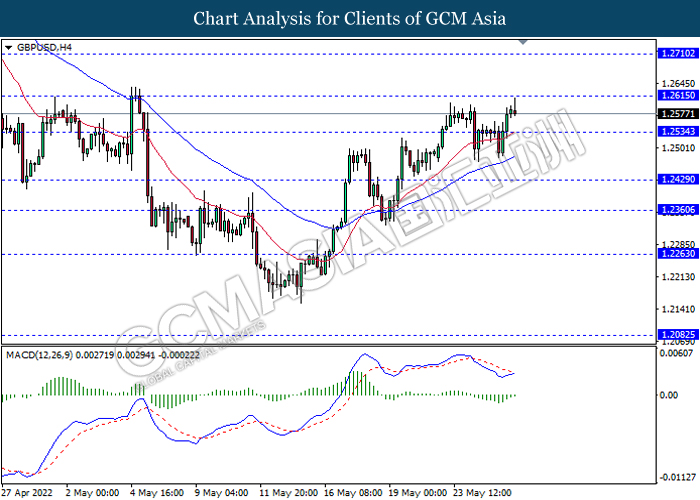

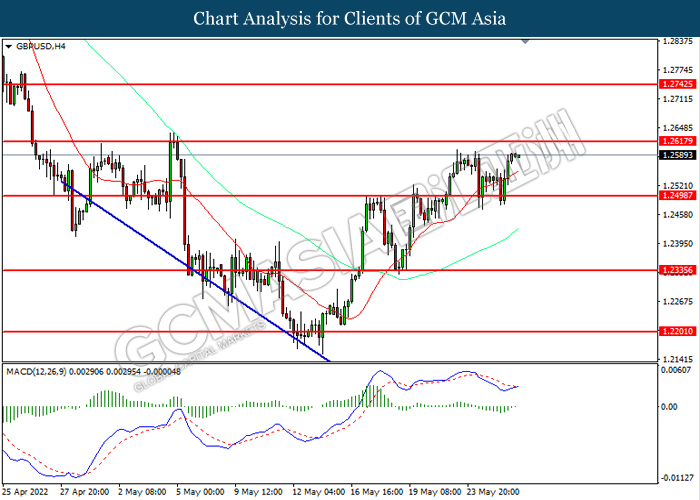

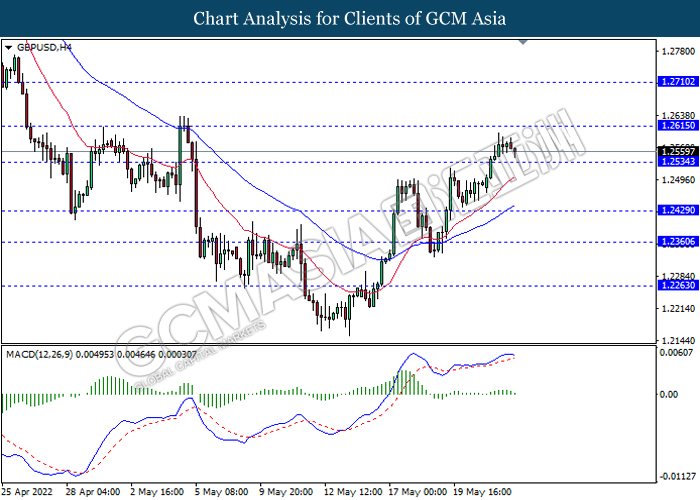

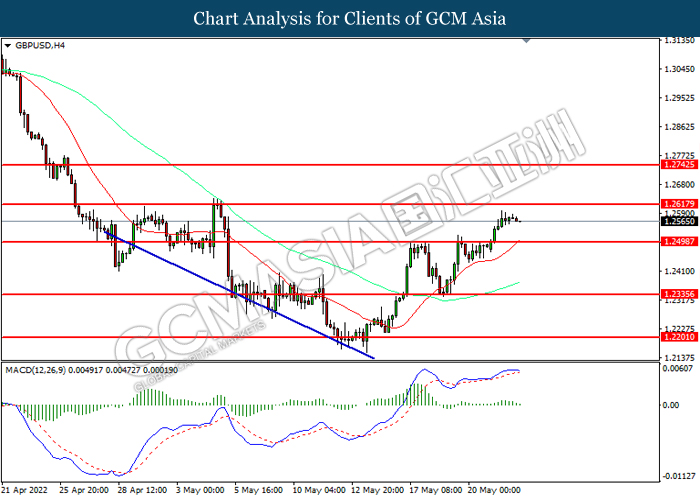

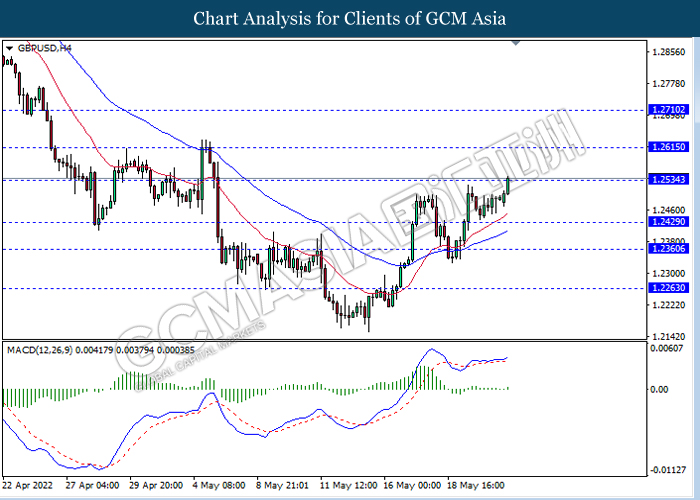

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2585. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2700, 1.2825

Support level: 1.2585, 1.2425

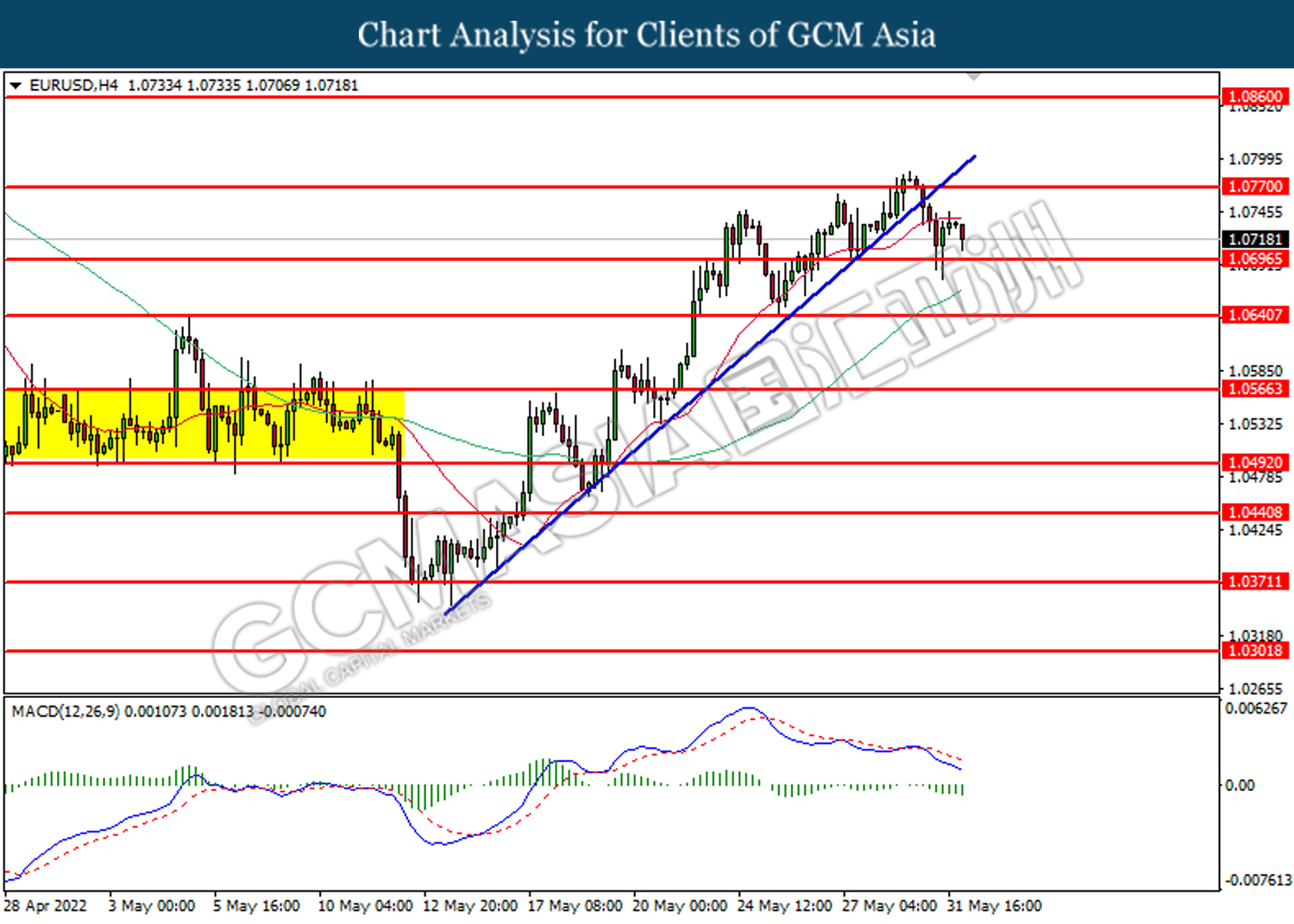

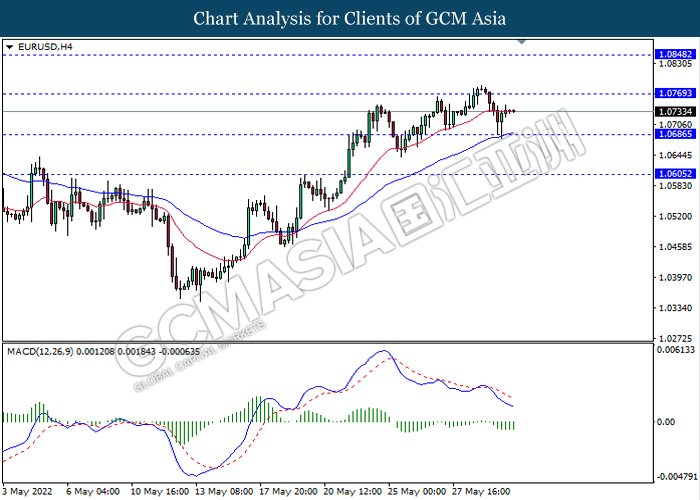

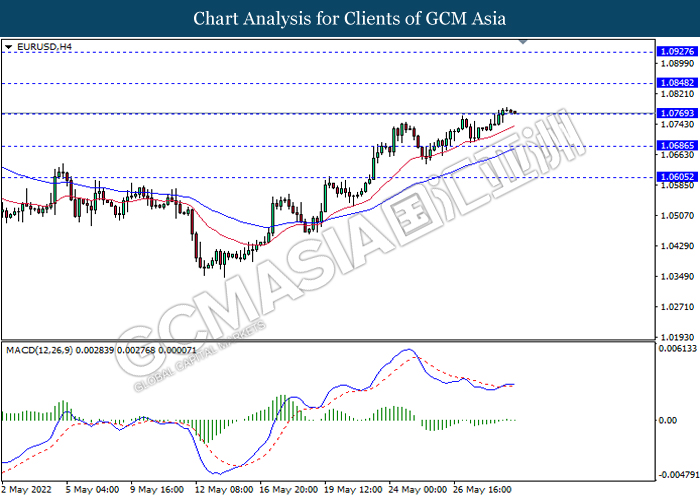

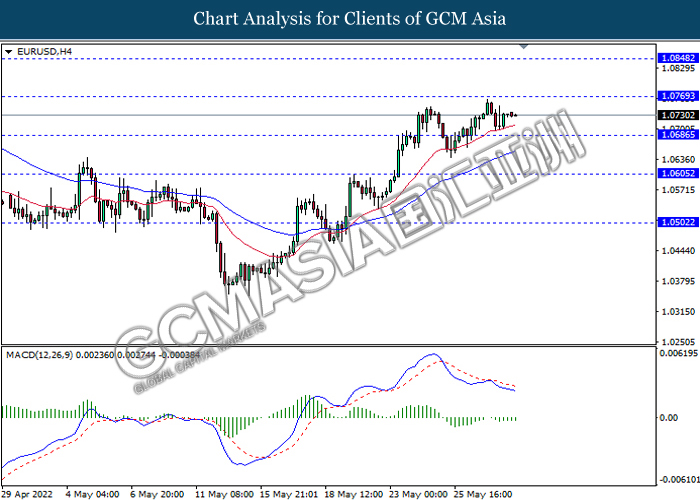

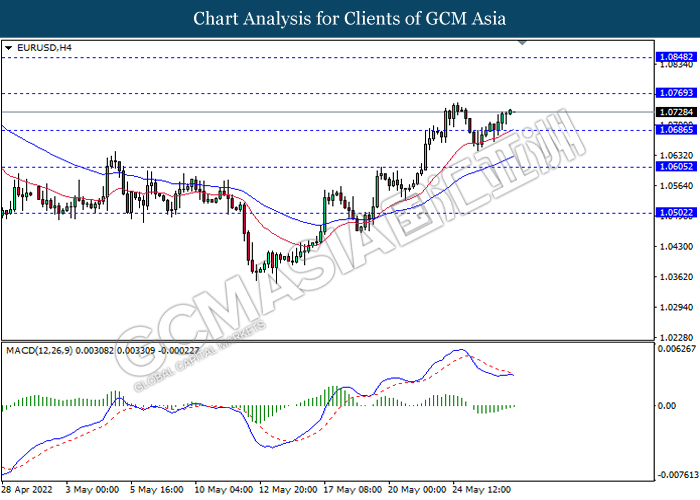

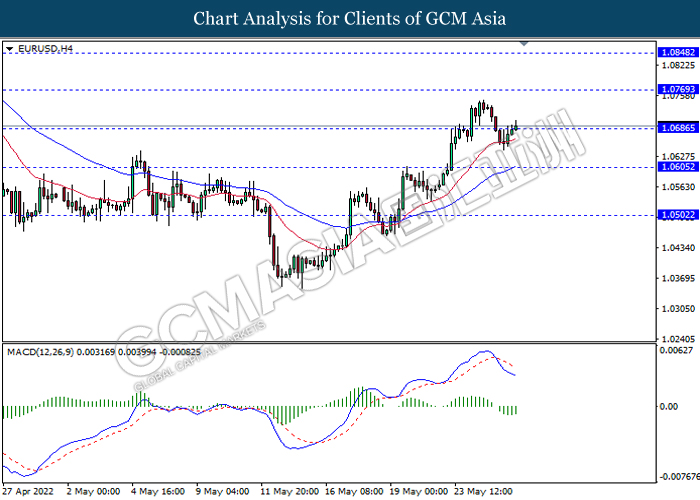

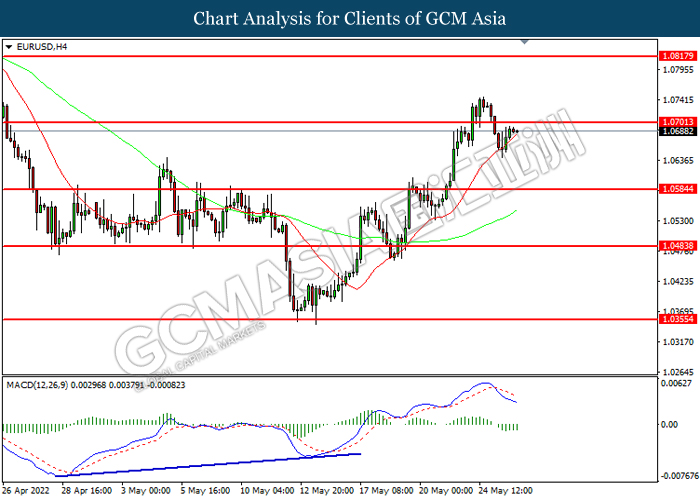

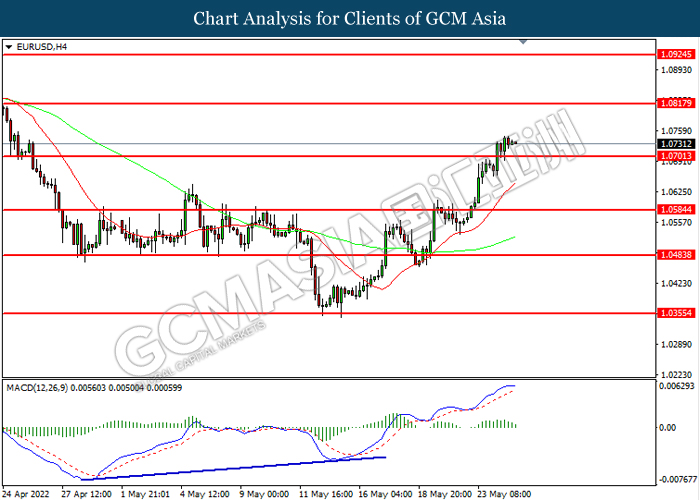

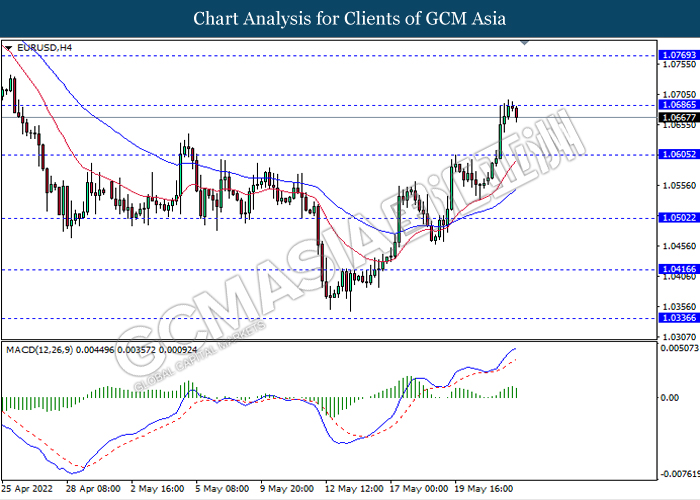

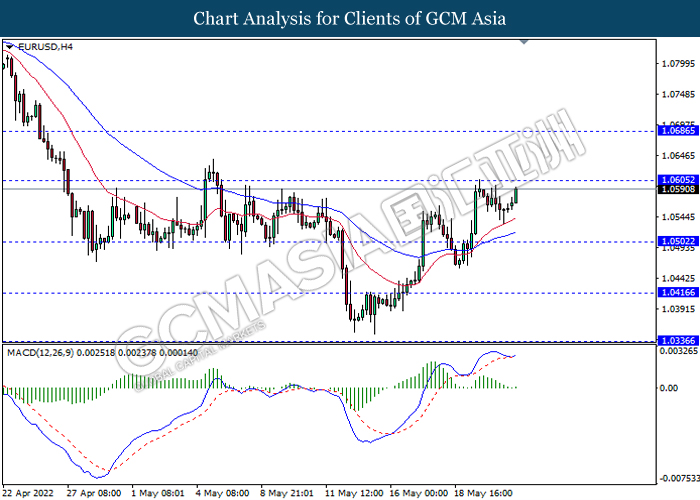

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its retracement toward the support level at 1.0695.

Resistance level: 1.0770, 1.0660

Support level: 1.0695, 1.0640

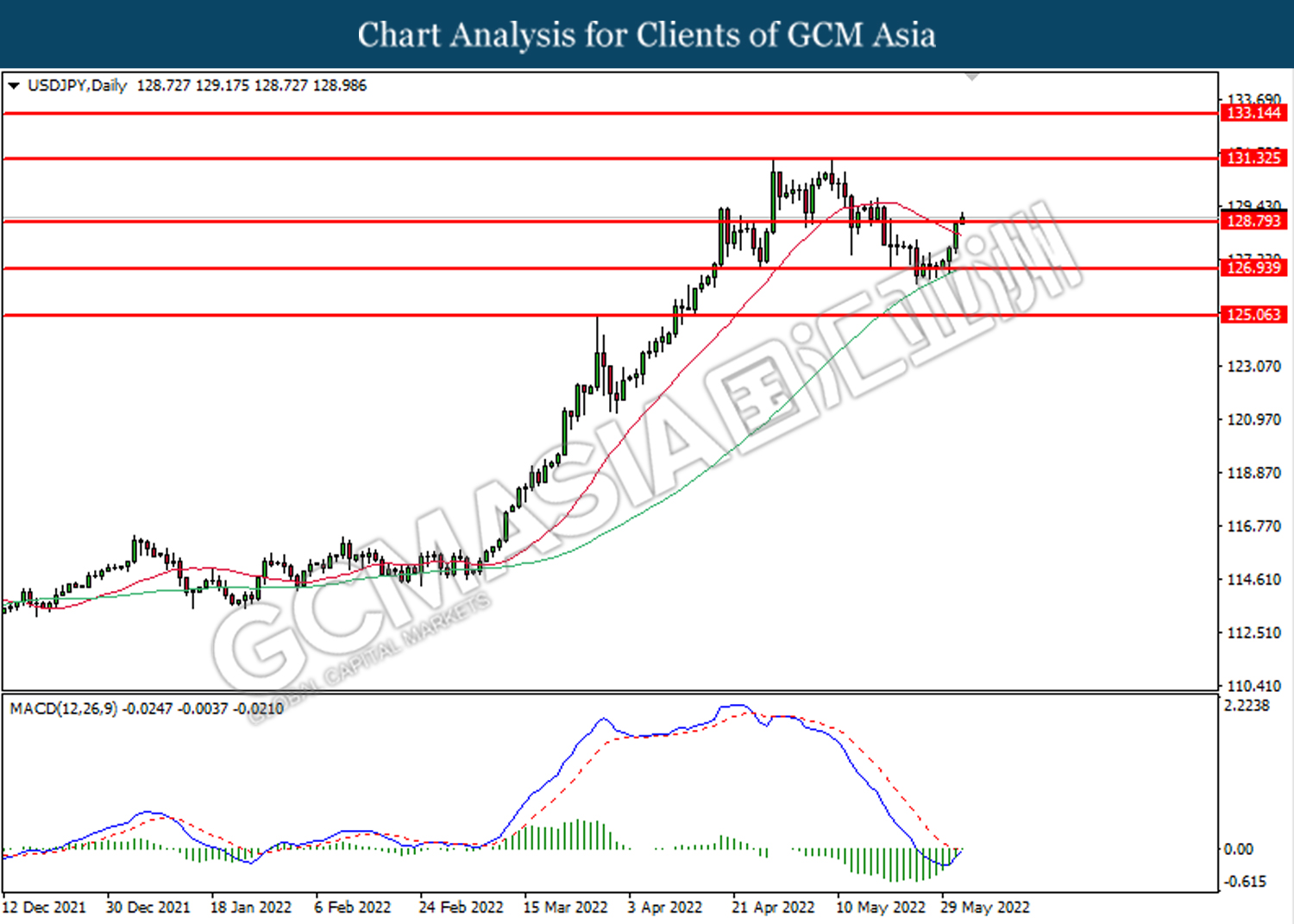

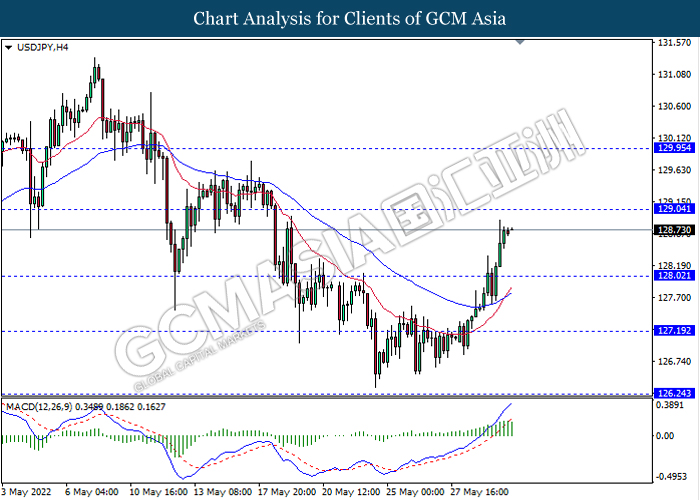

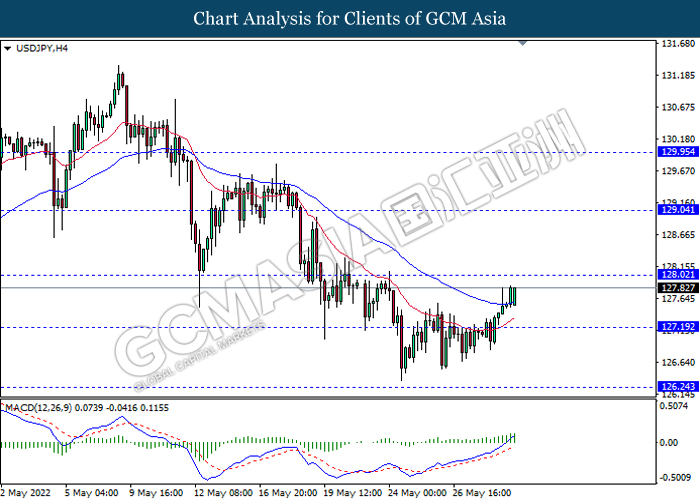

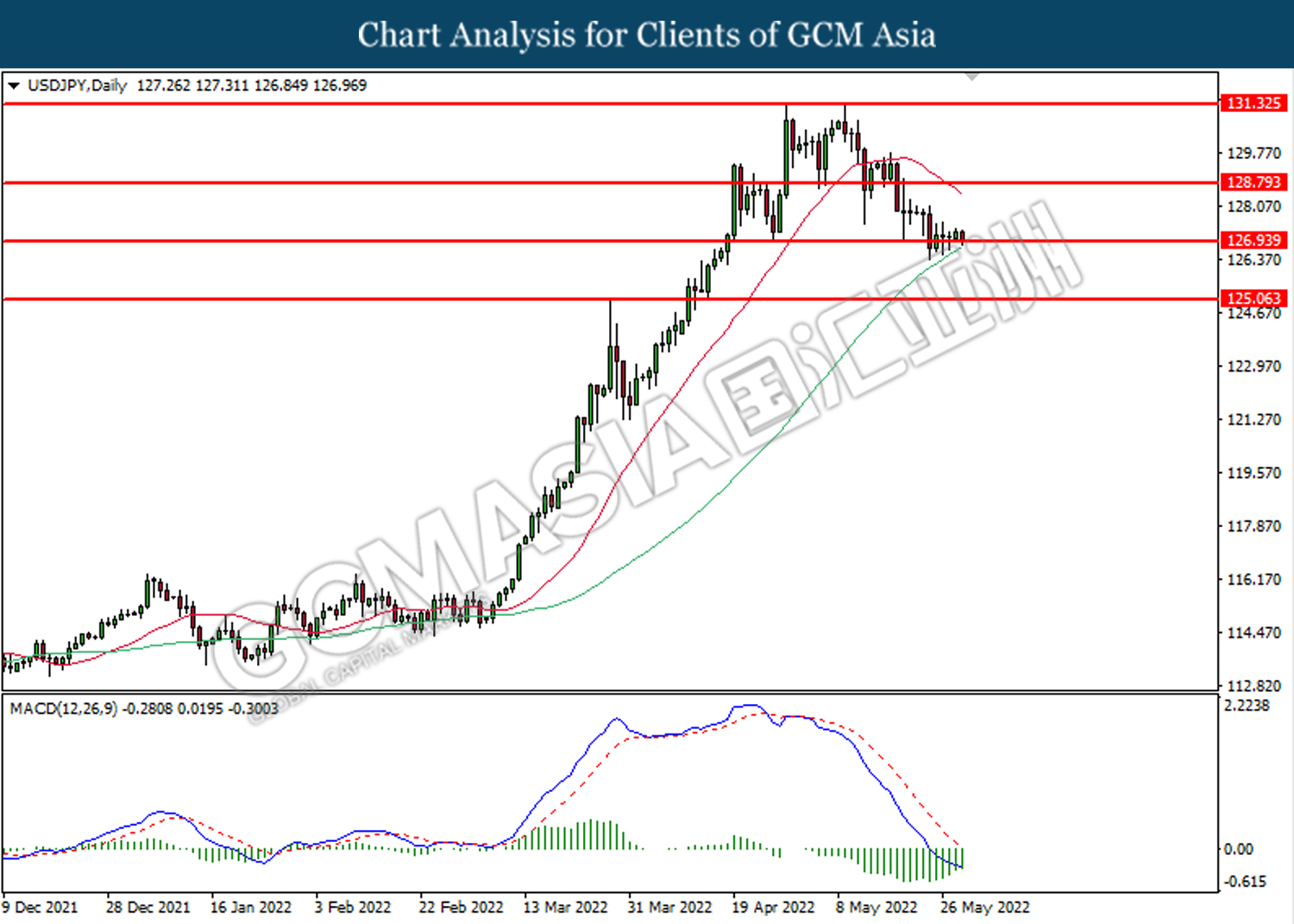

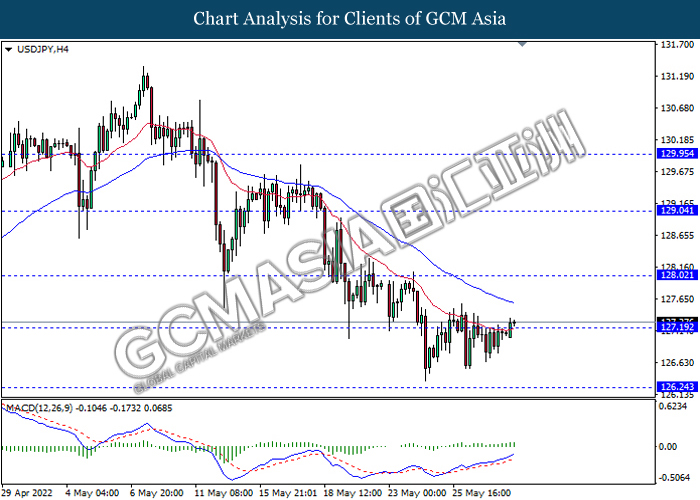

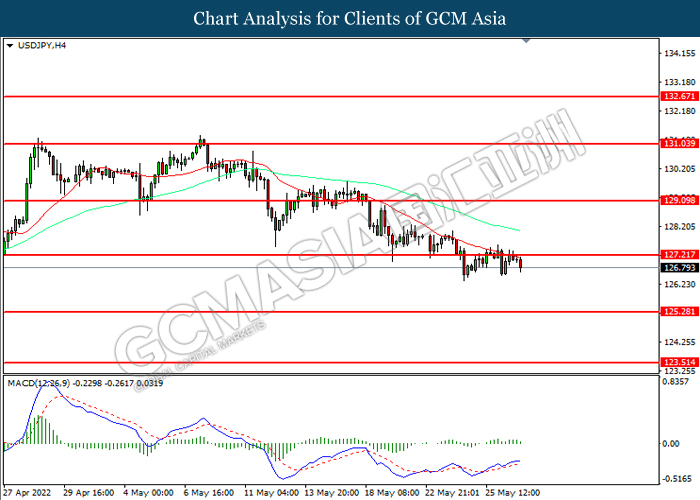

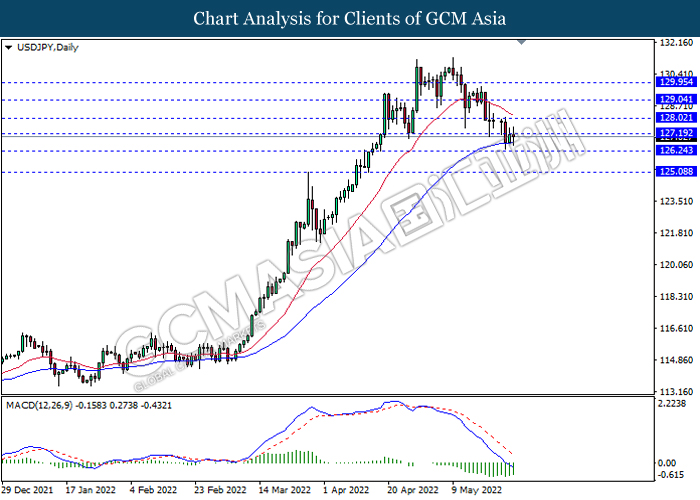

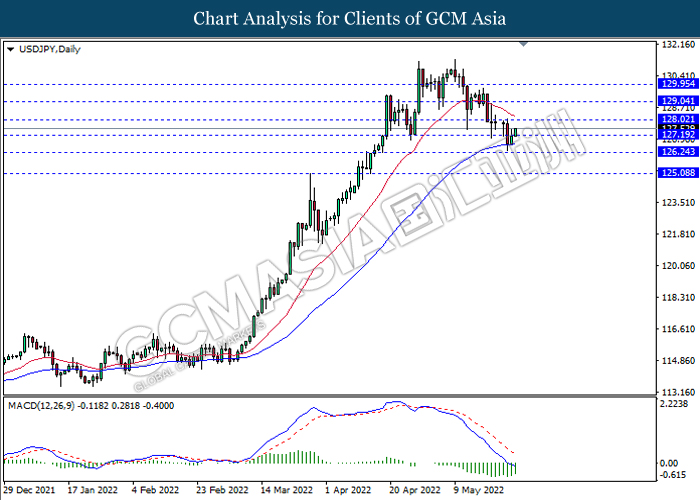

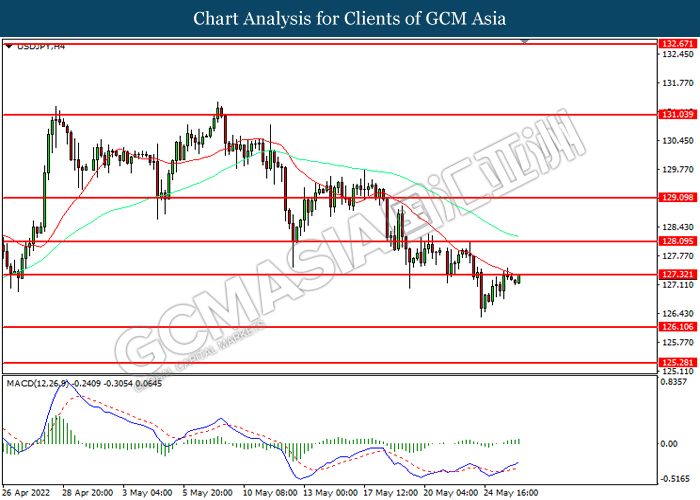

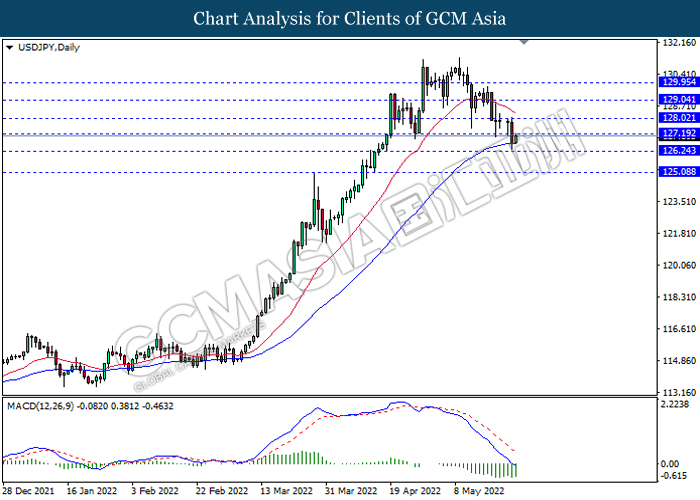

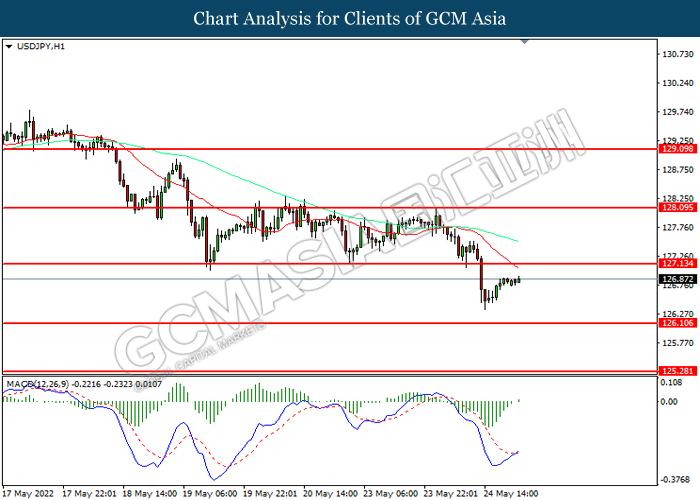

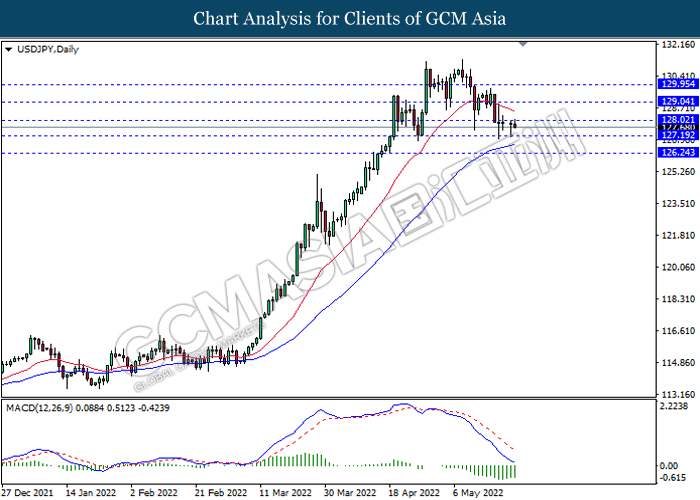

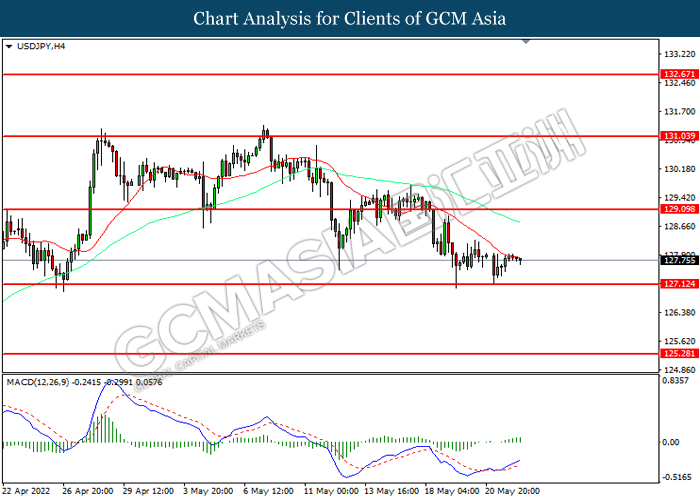

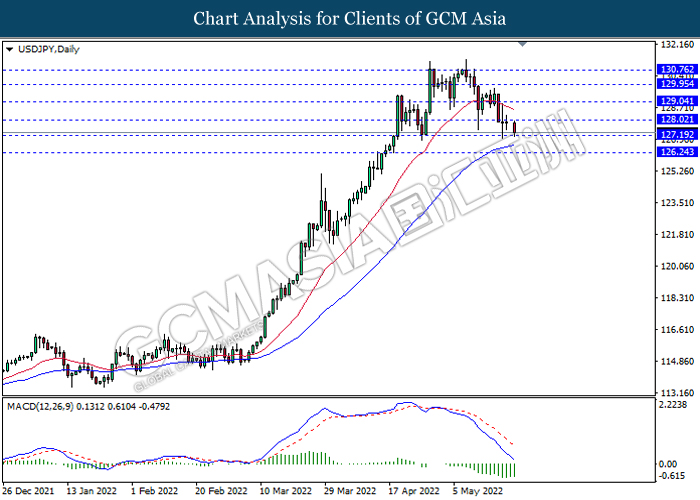

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 128.80. MACD which illustrated diminishing bearish momentum suggest the pair to be extend its gains after it successfully breakout above the resistance level.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

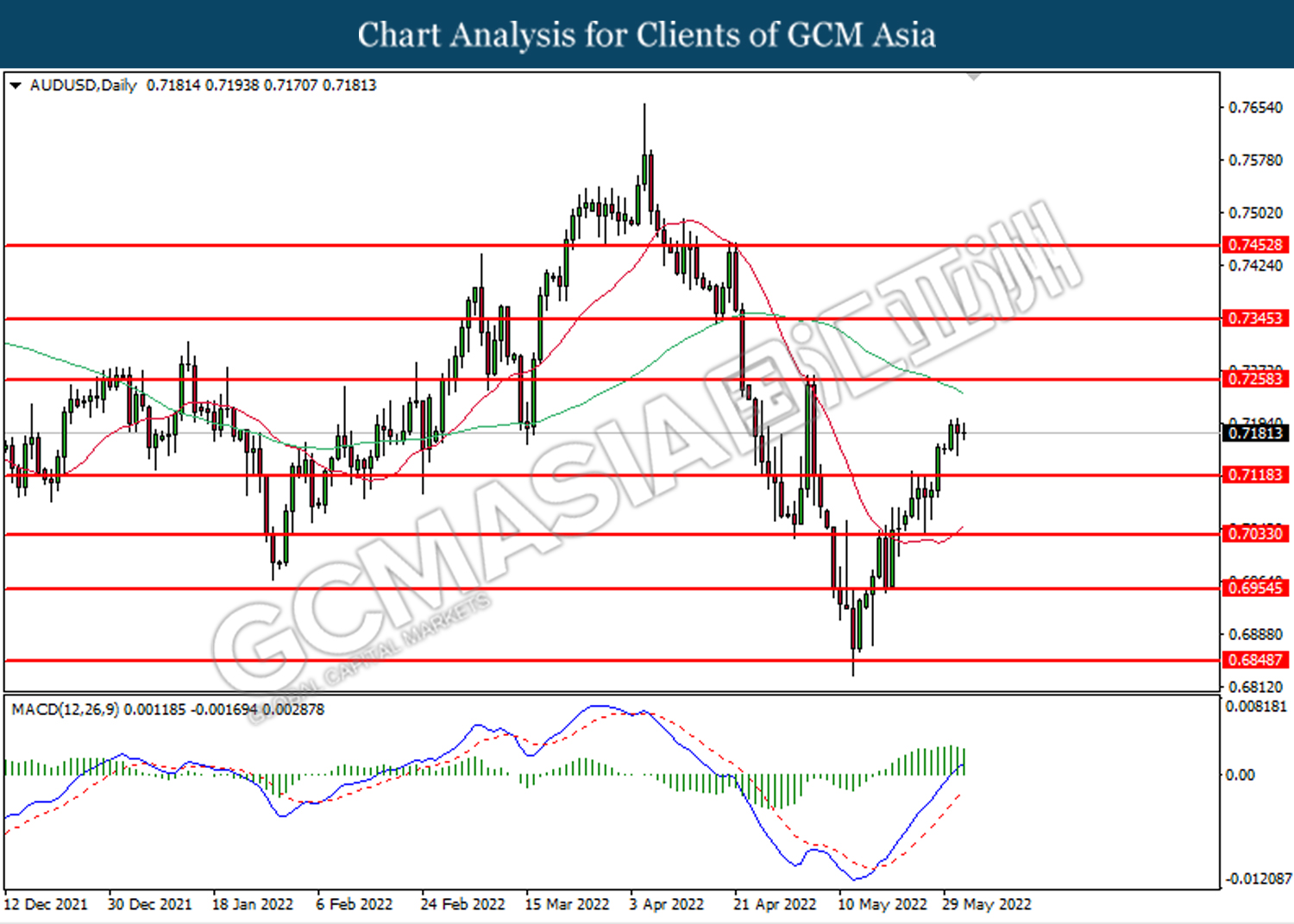

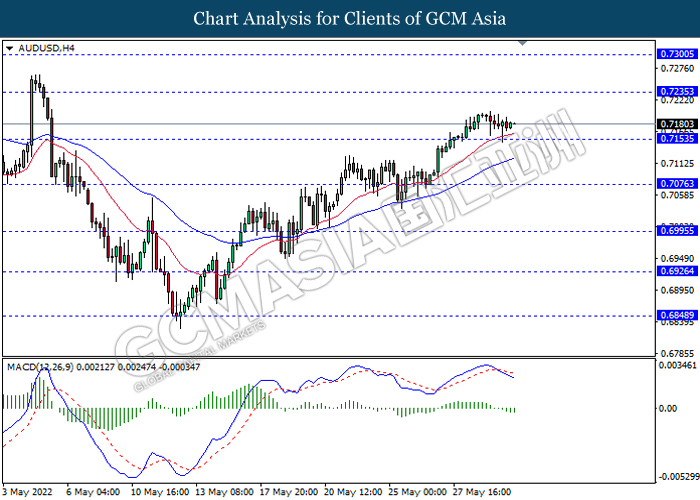

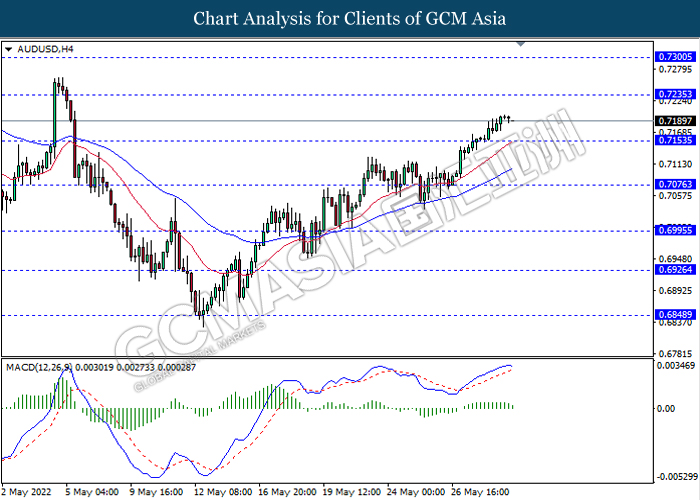

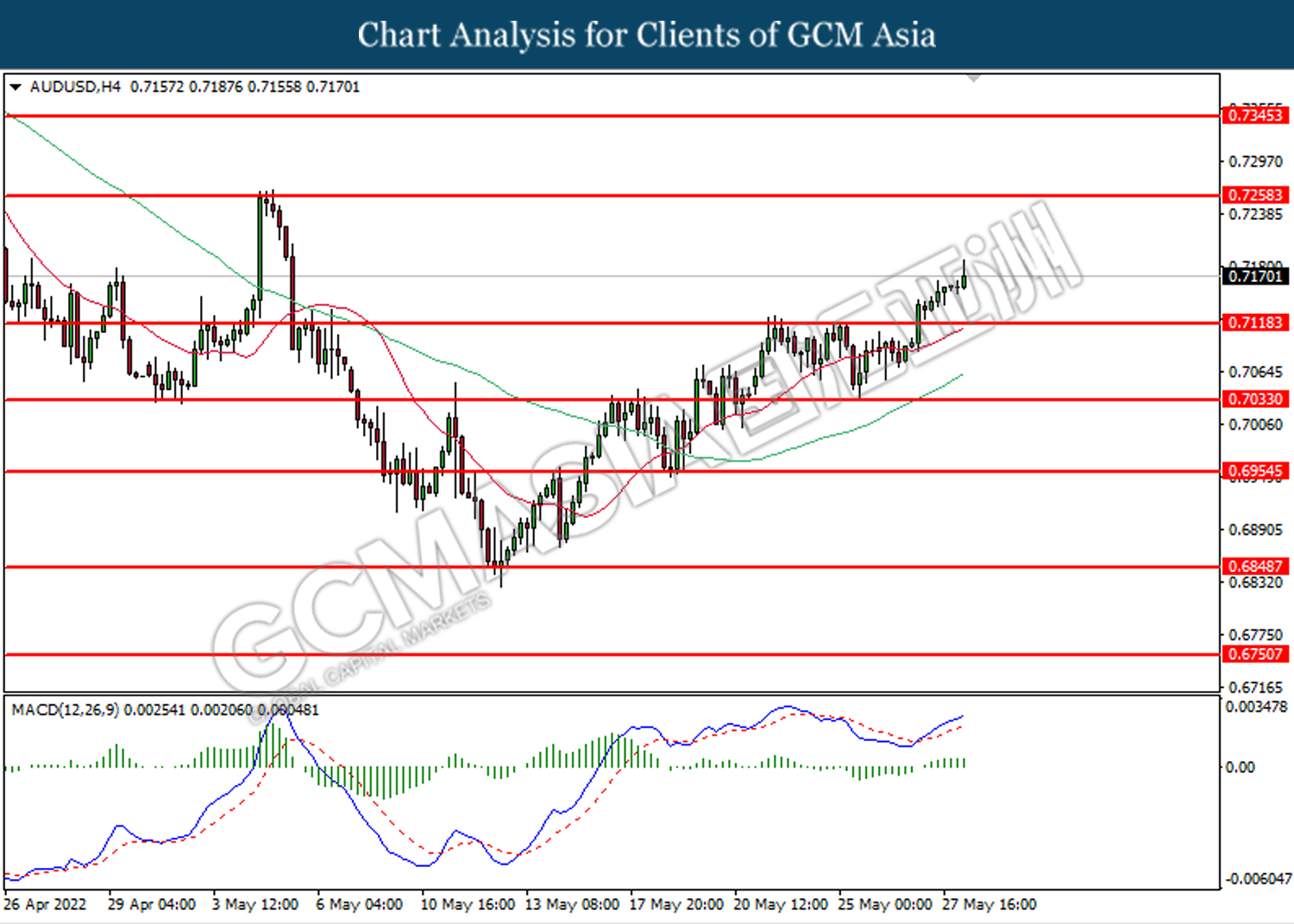

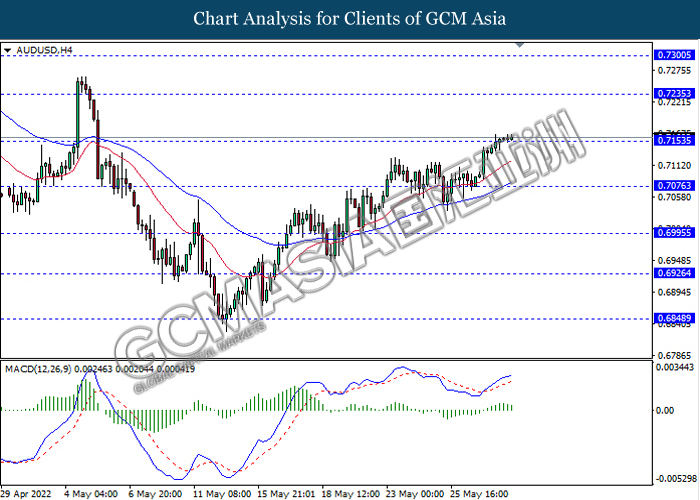

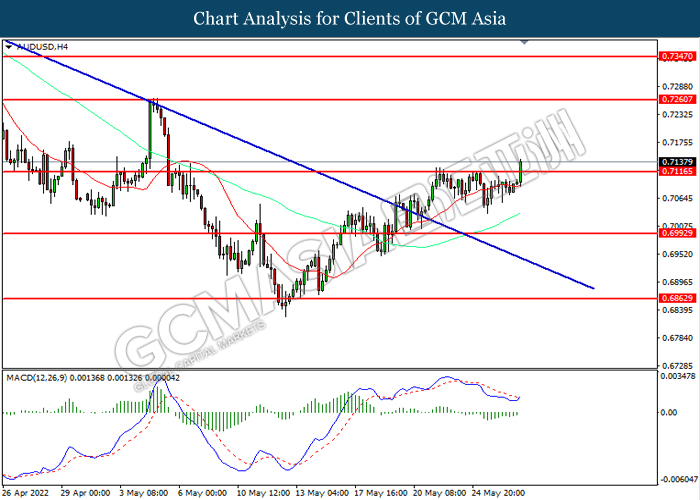

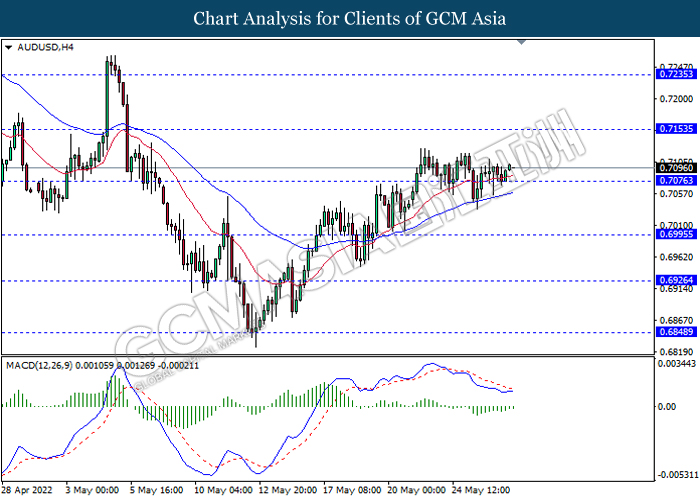

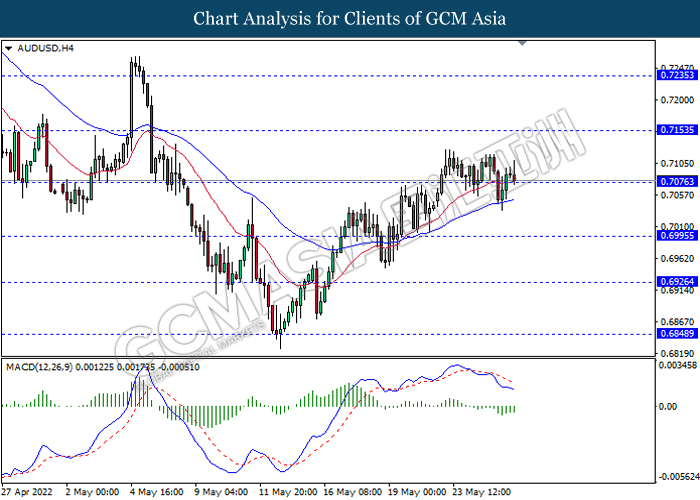

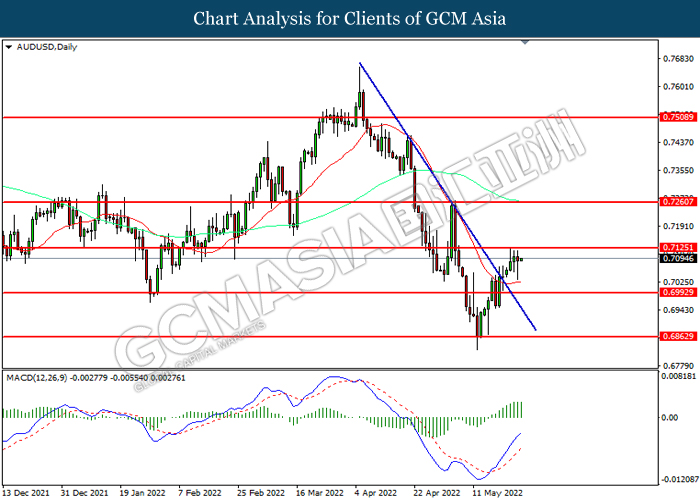

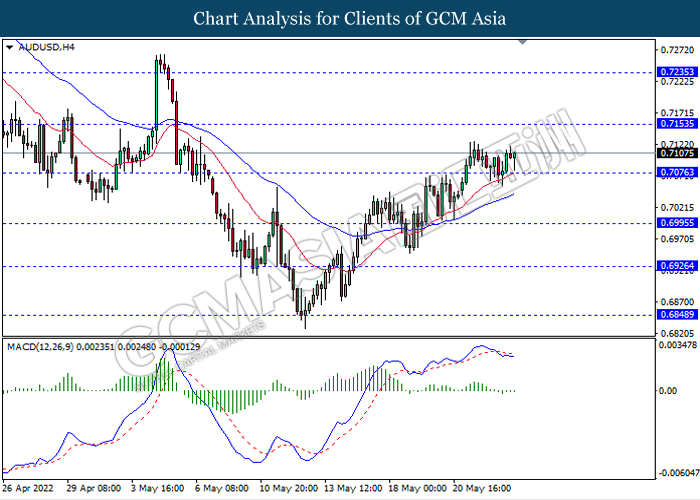

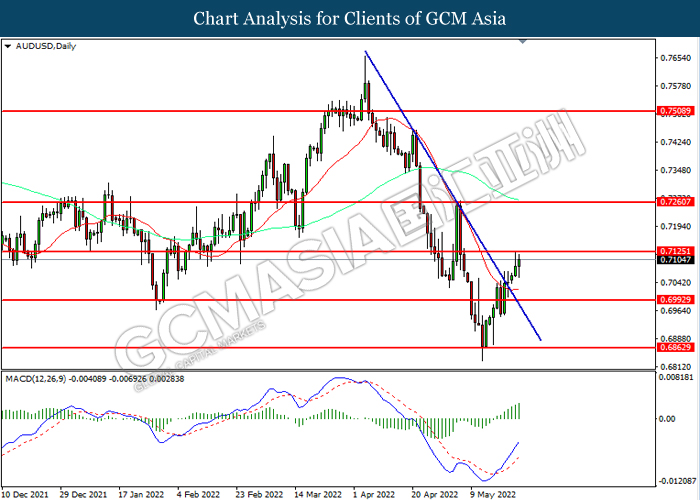

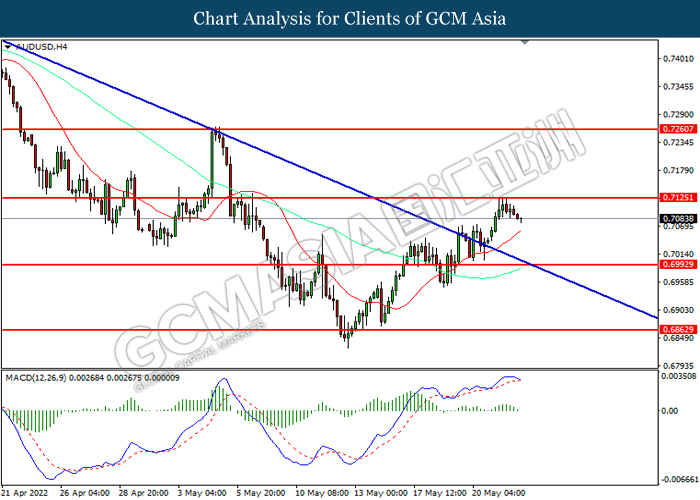

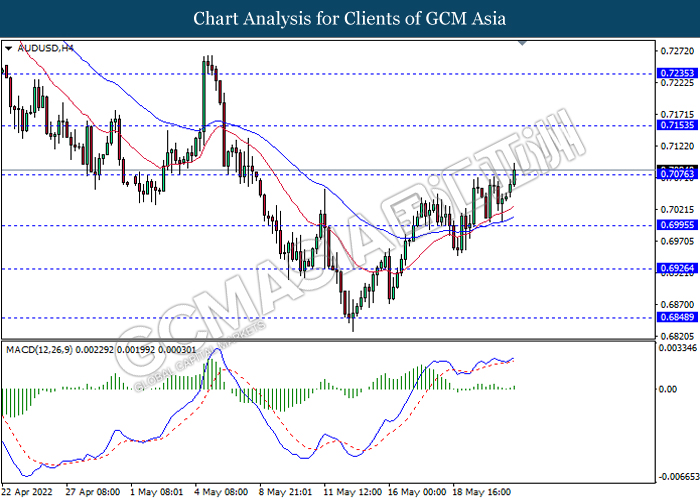

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

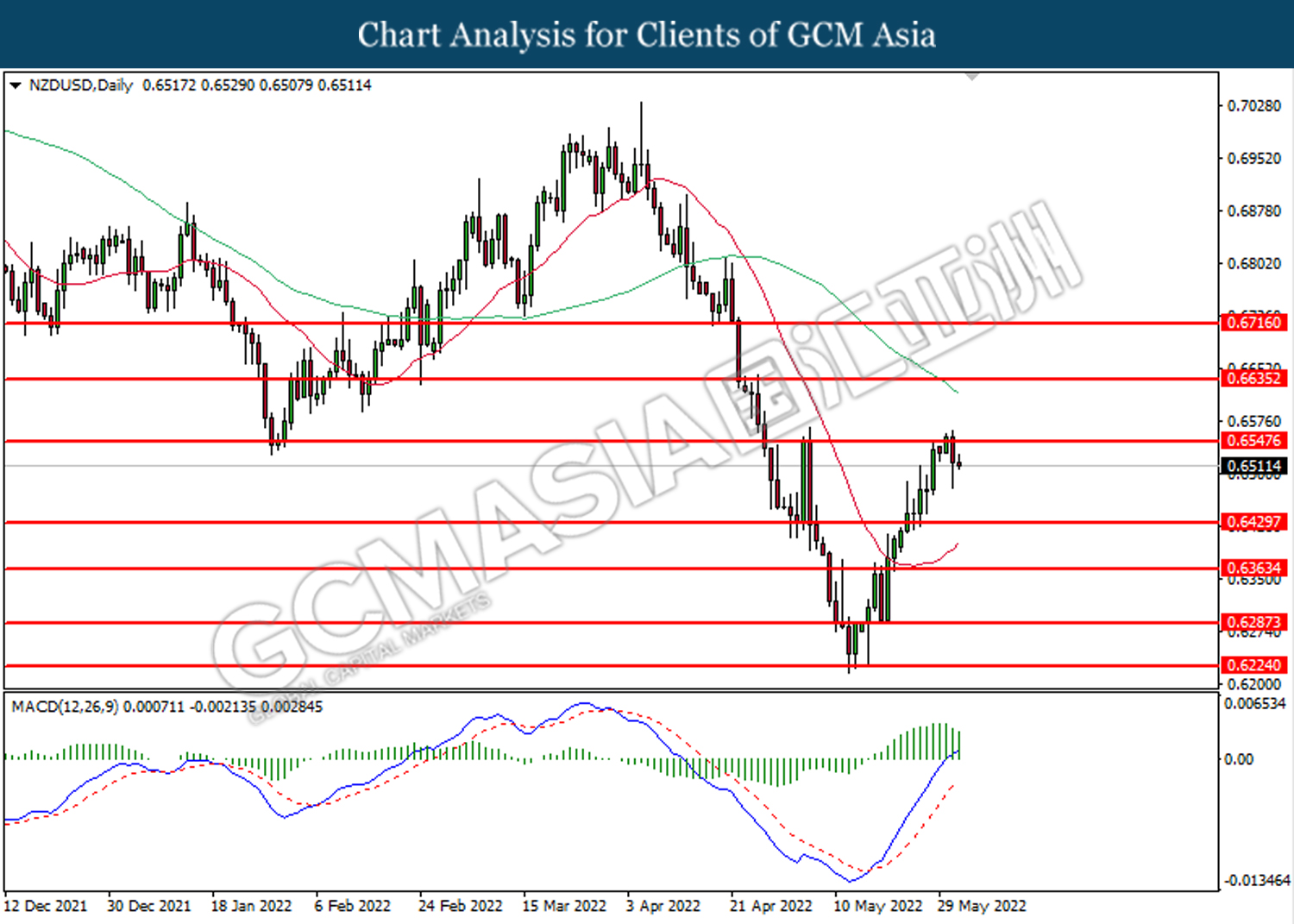

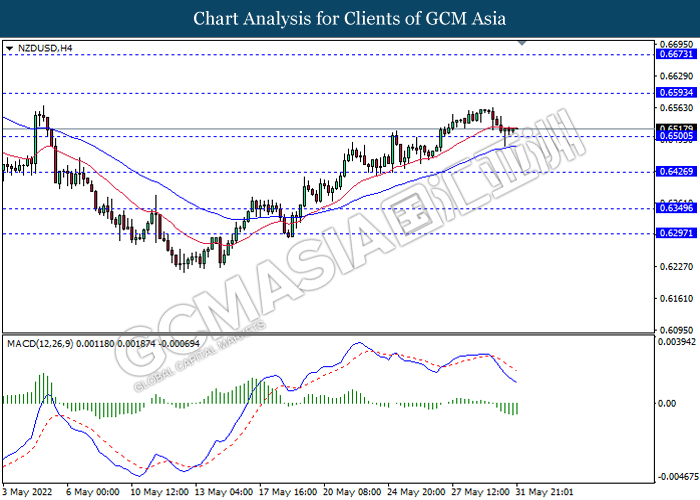

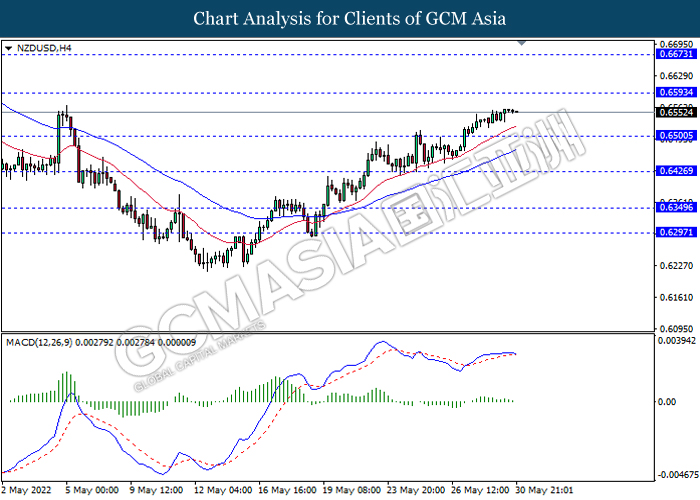

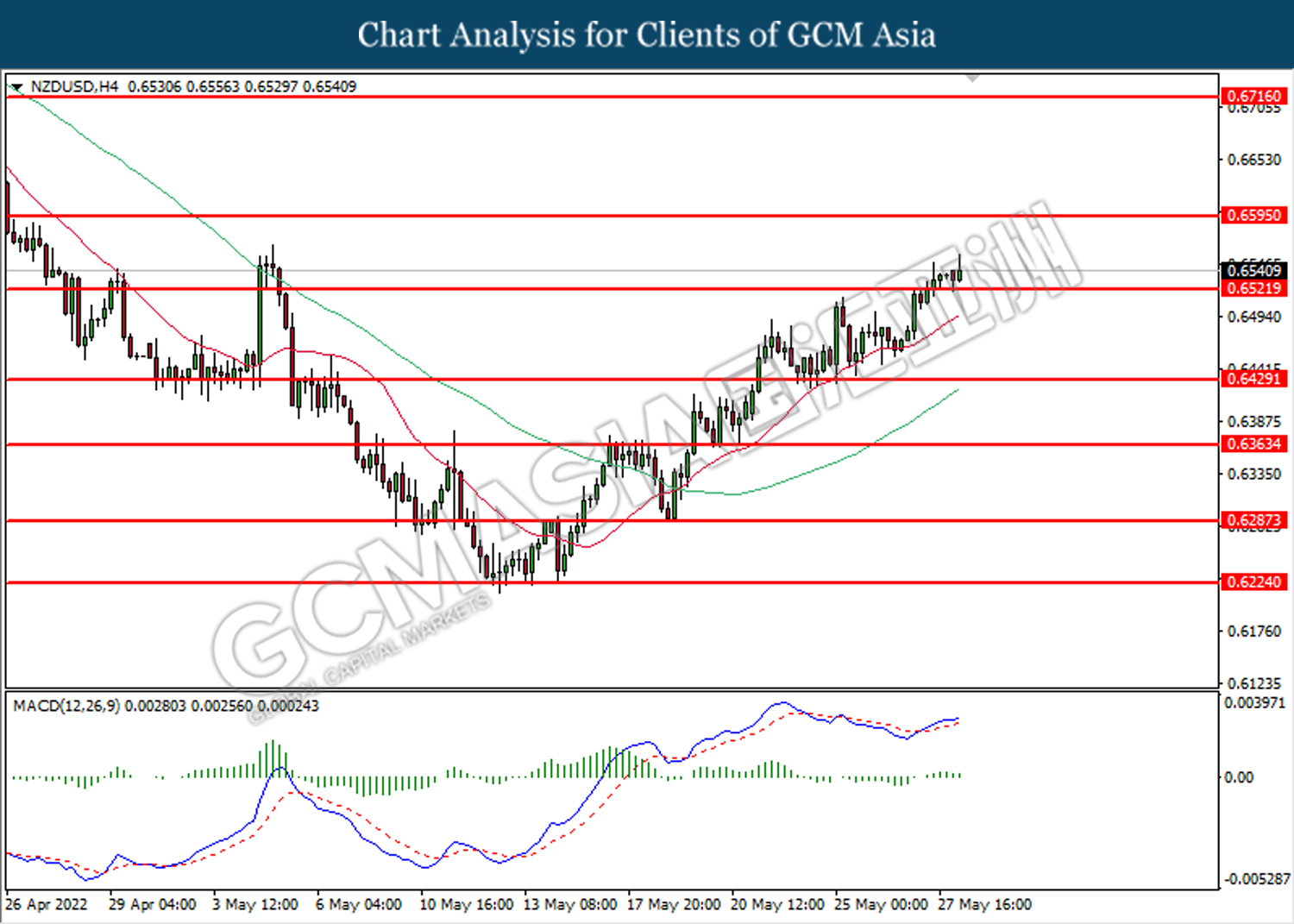

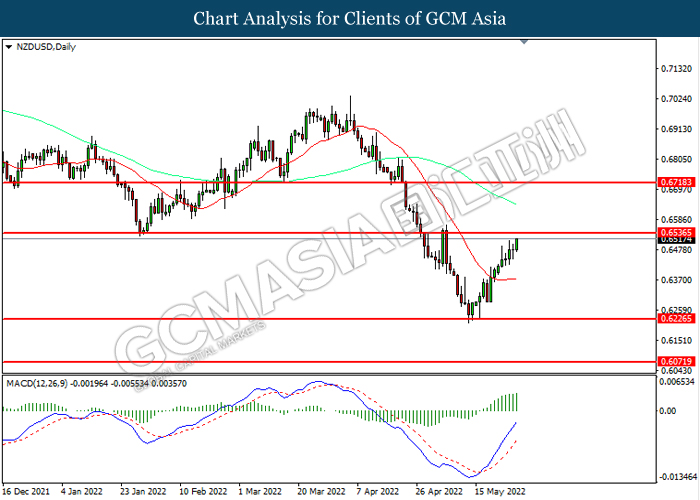

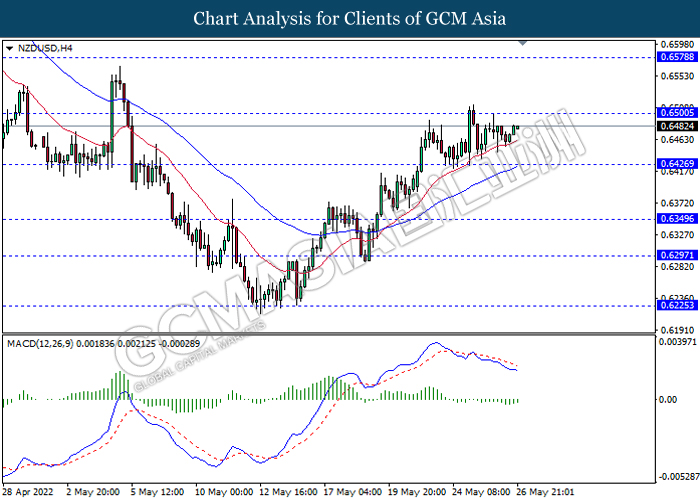

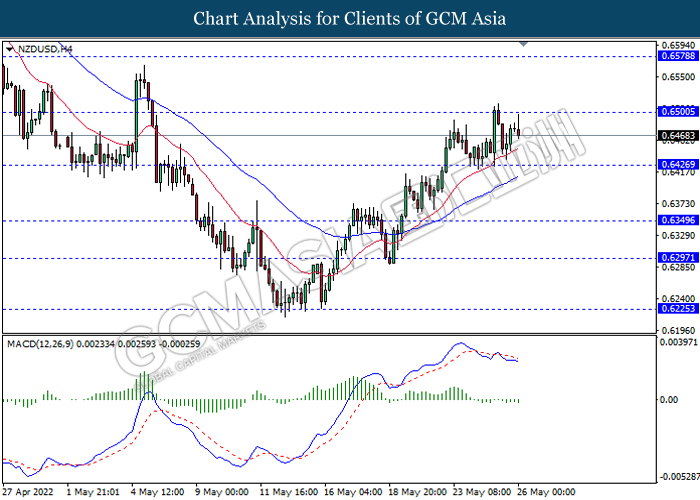

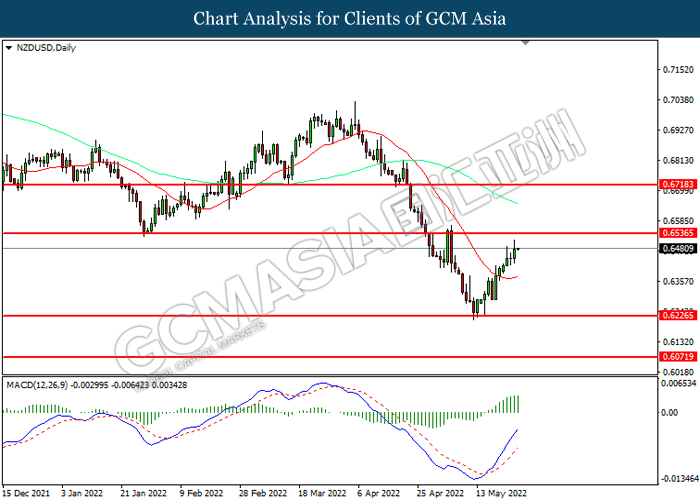

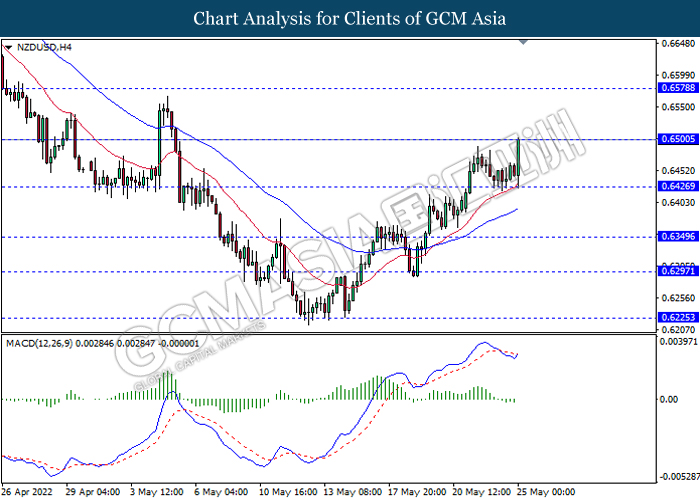

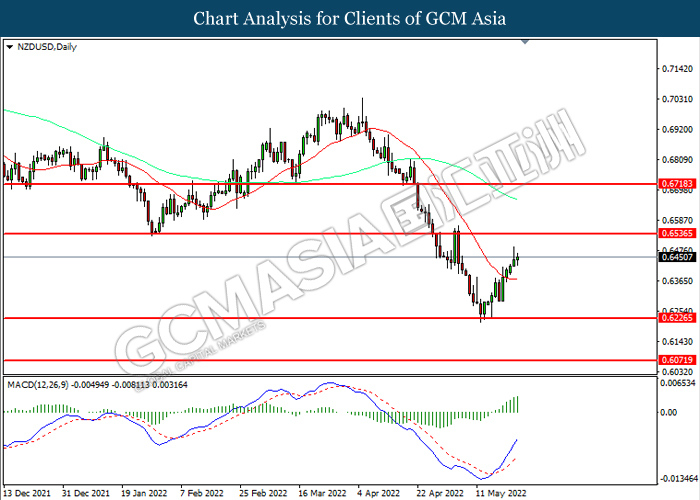

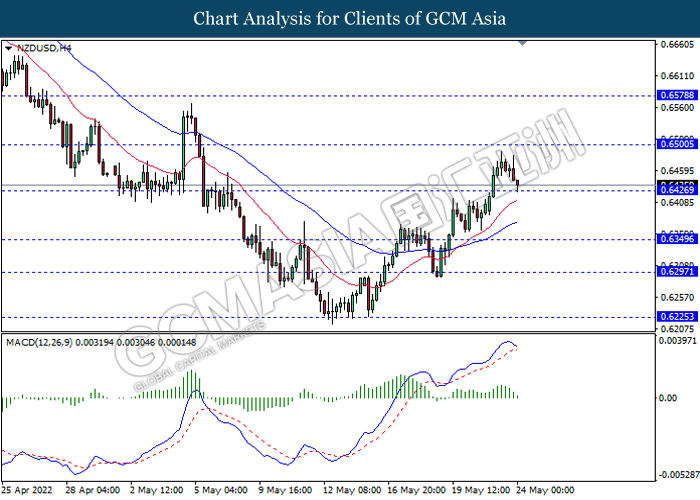

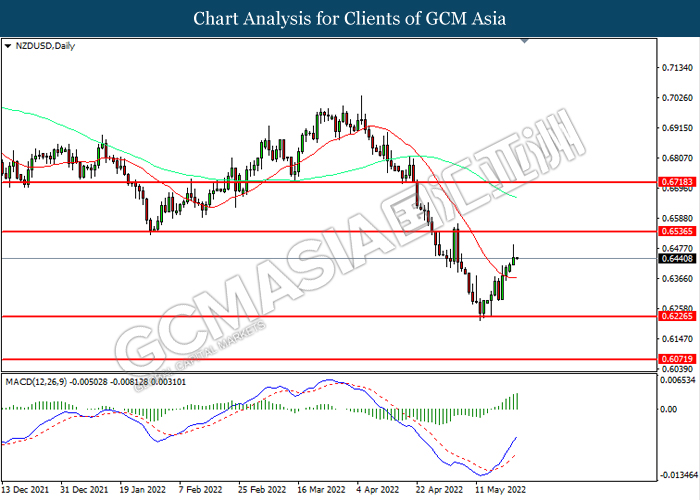

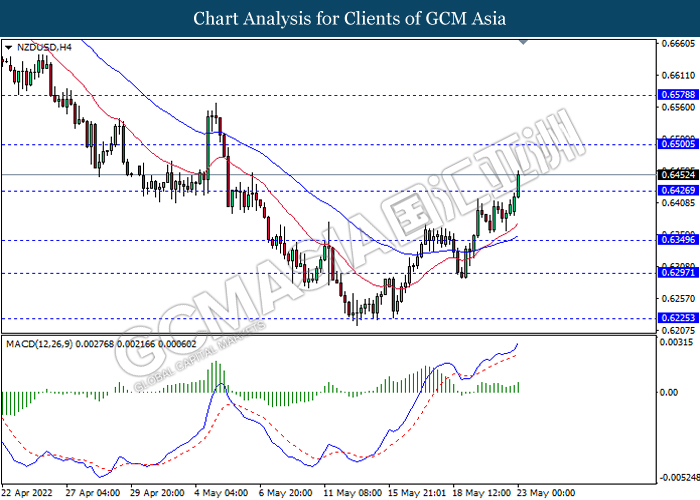

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6545. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6430.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

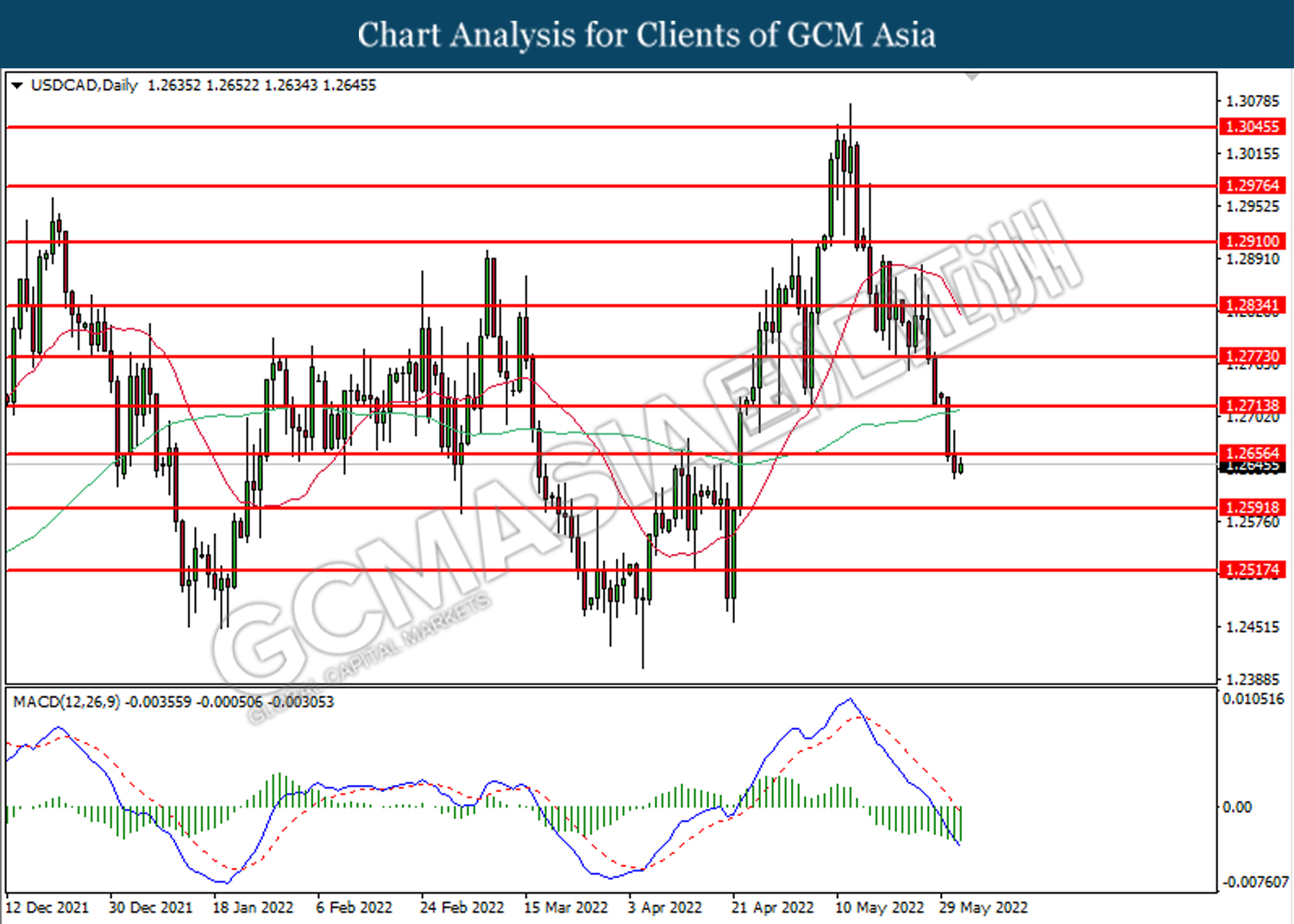

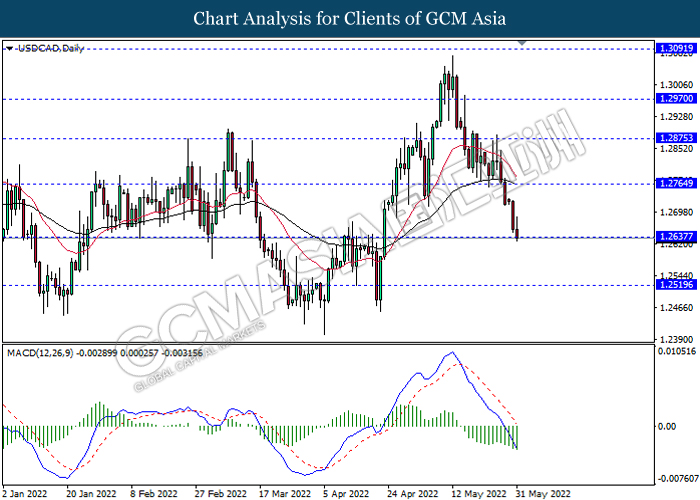

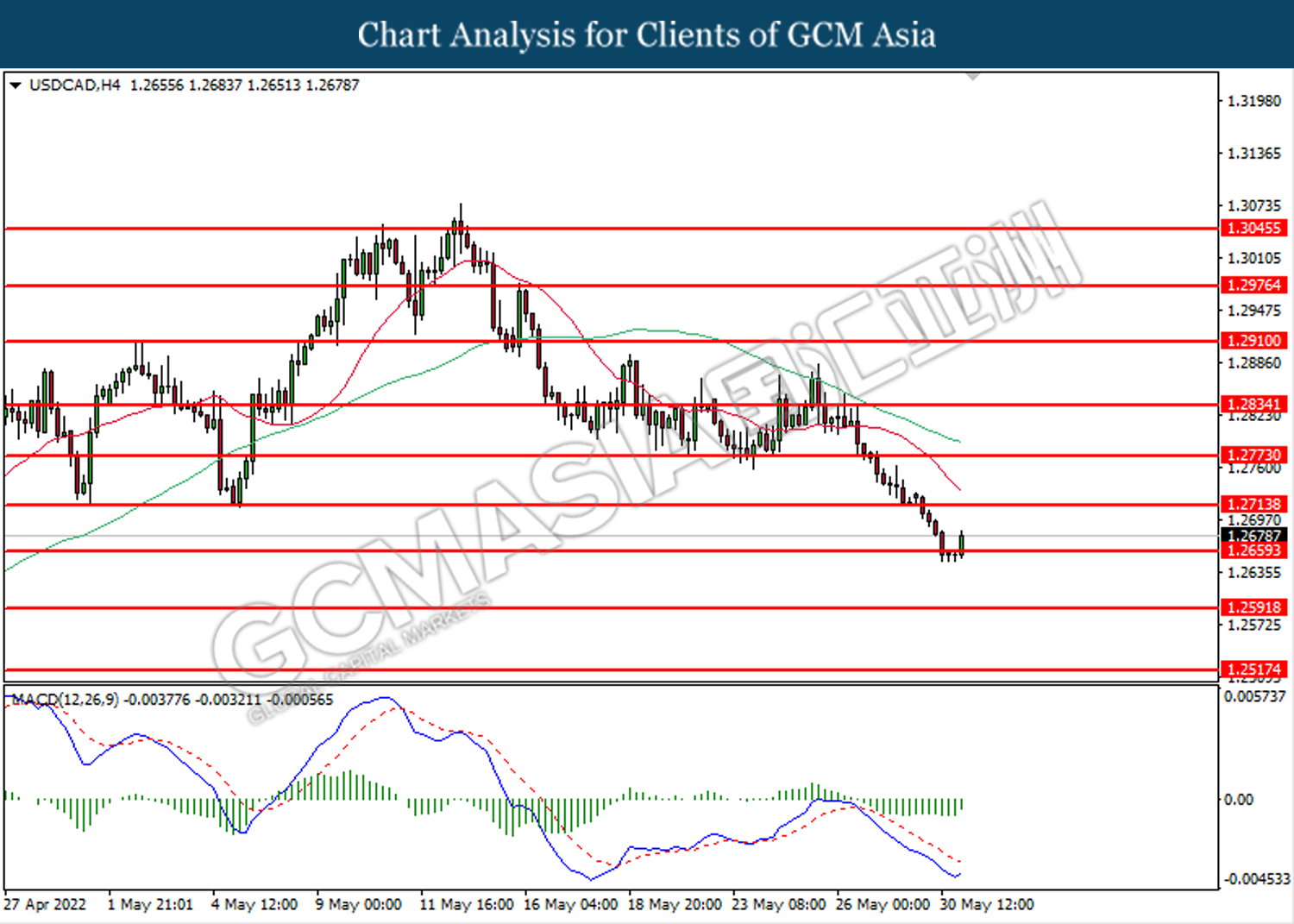

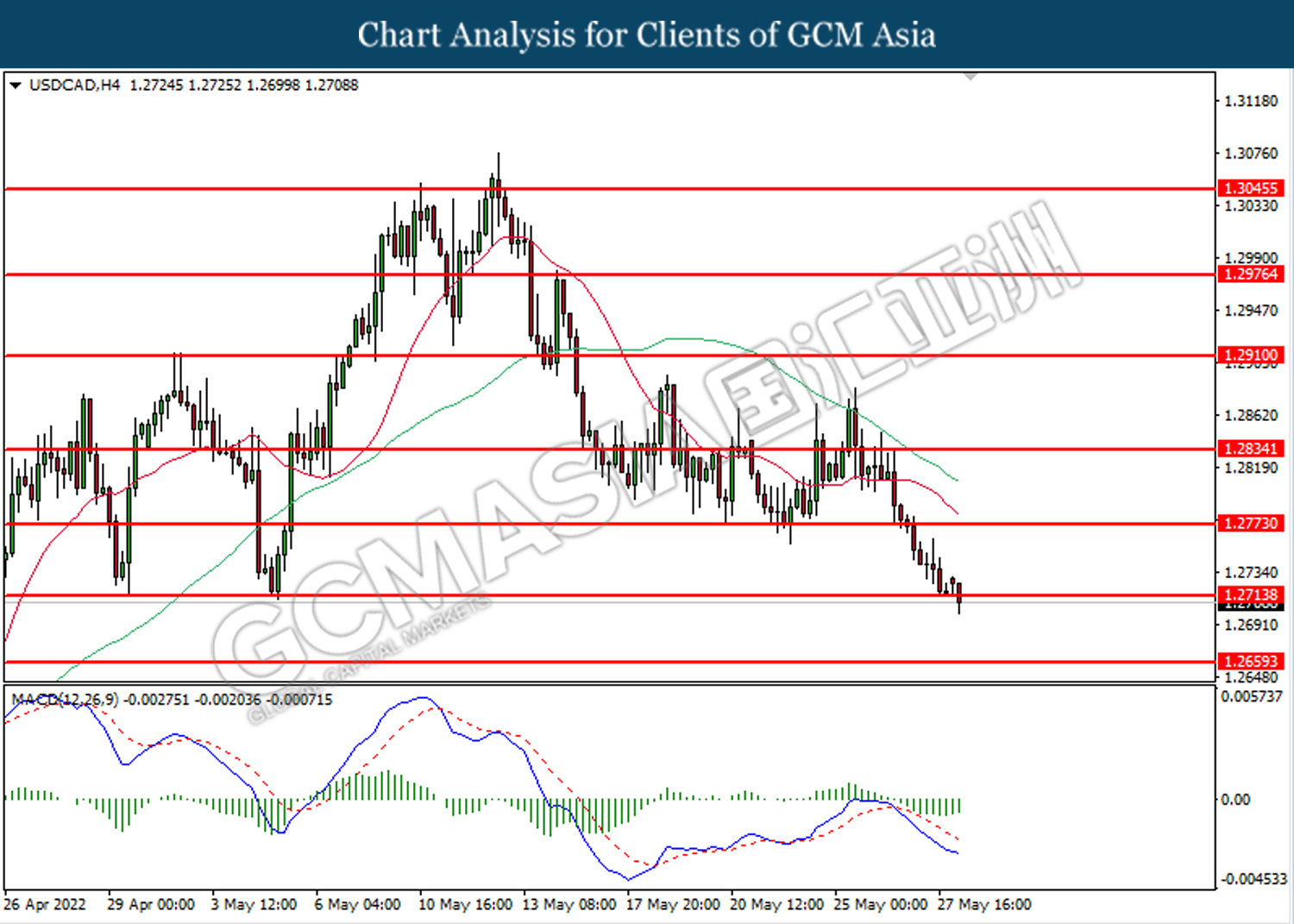

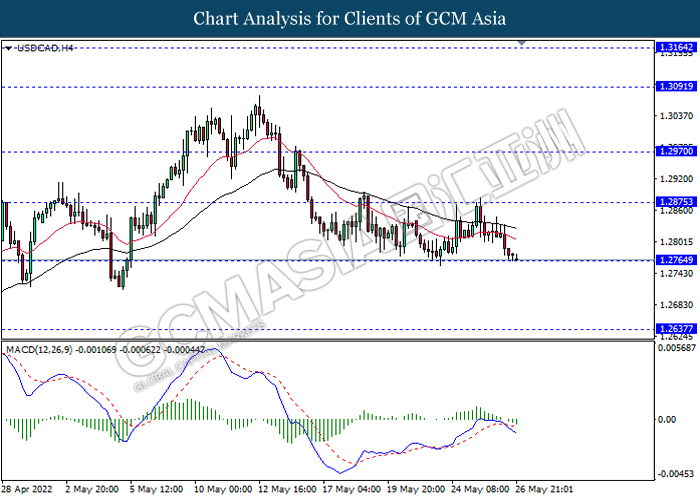

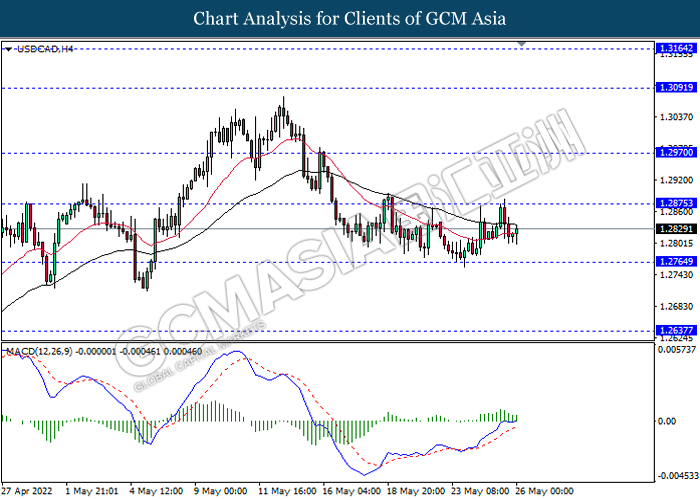

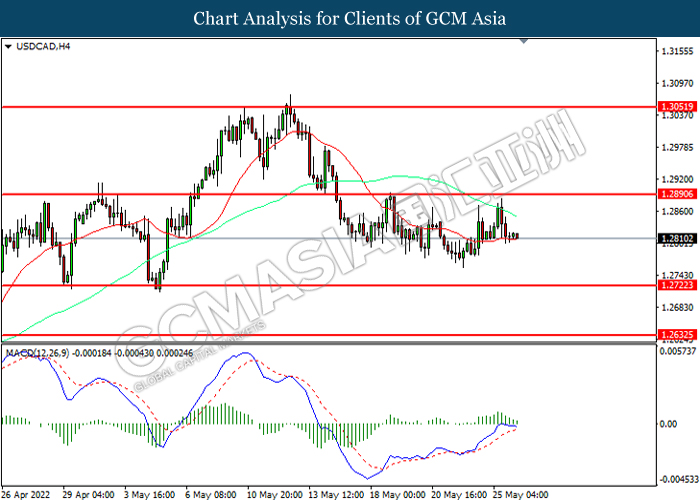

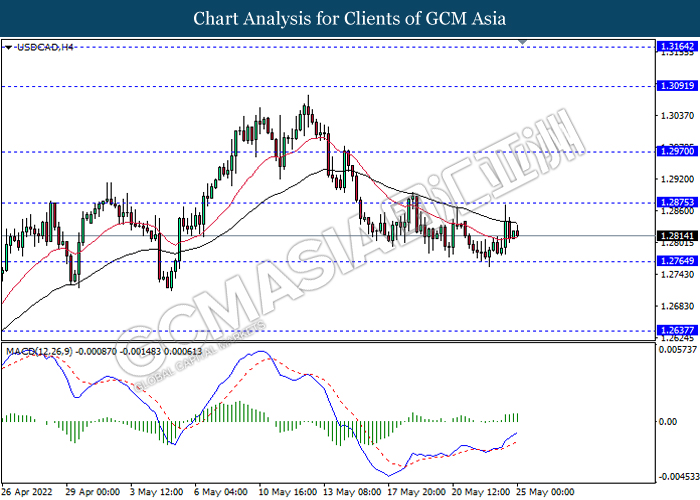

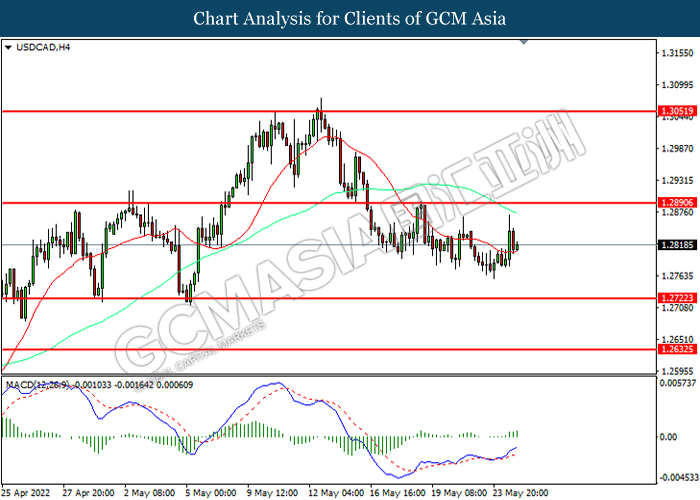

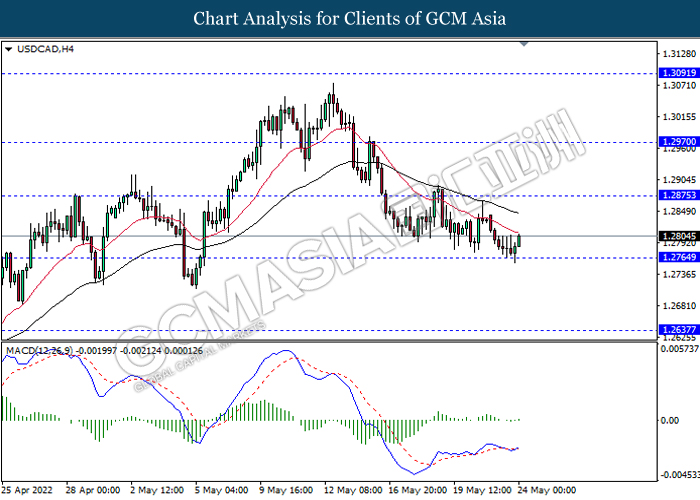

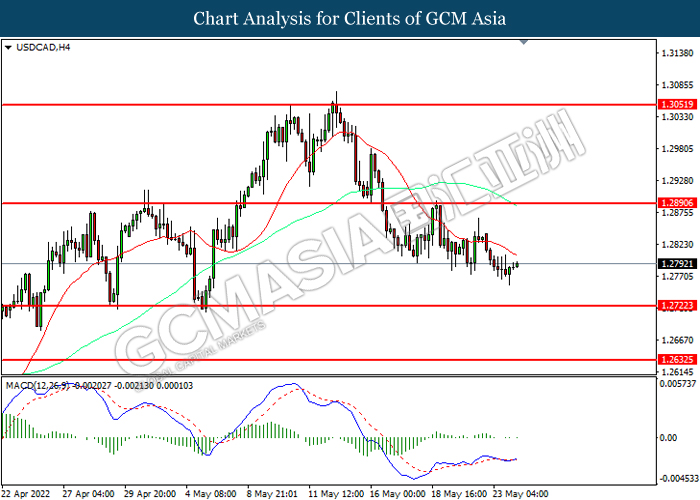

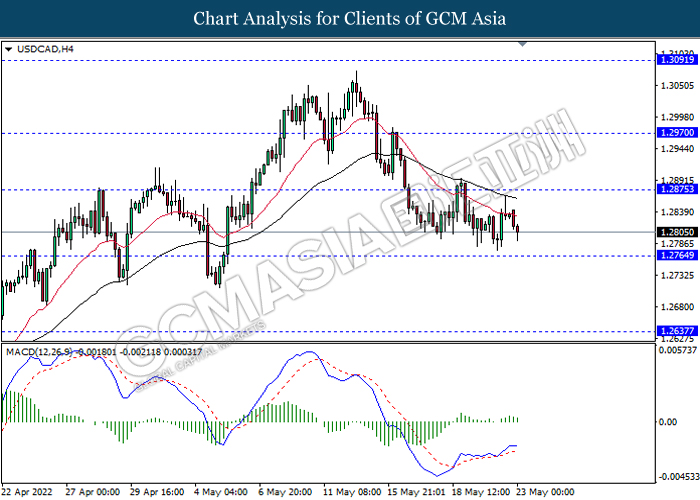

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2655. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2590.

Resistance level: 1.2655, 1.2715

Support level: 1.2590, 1.2515

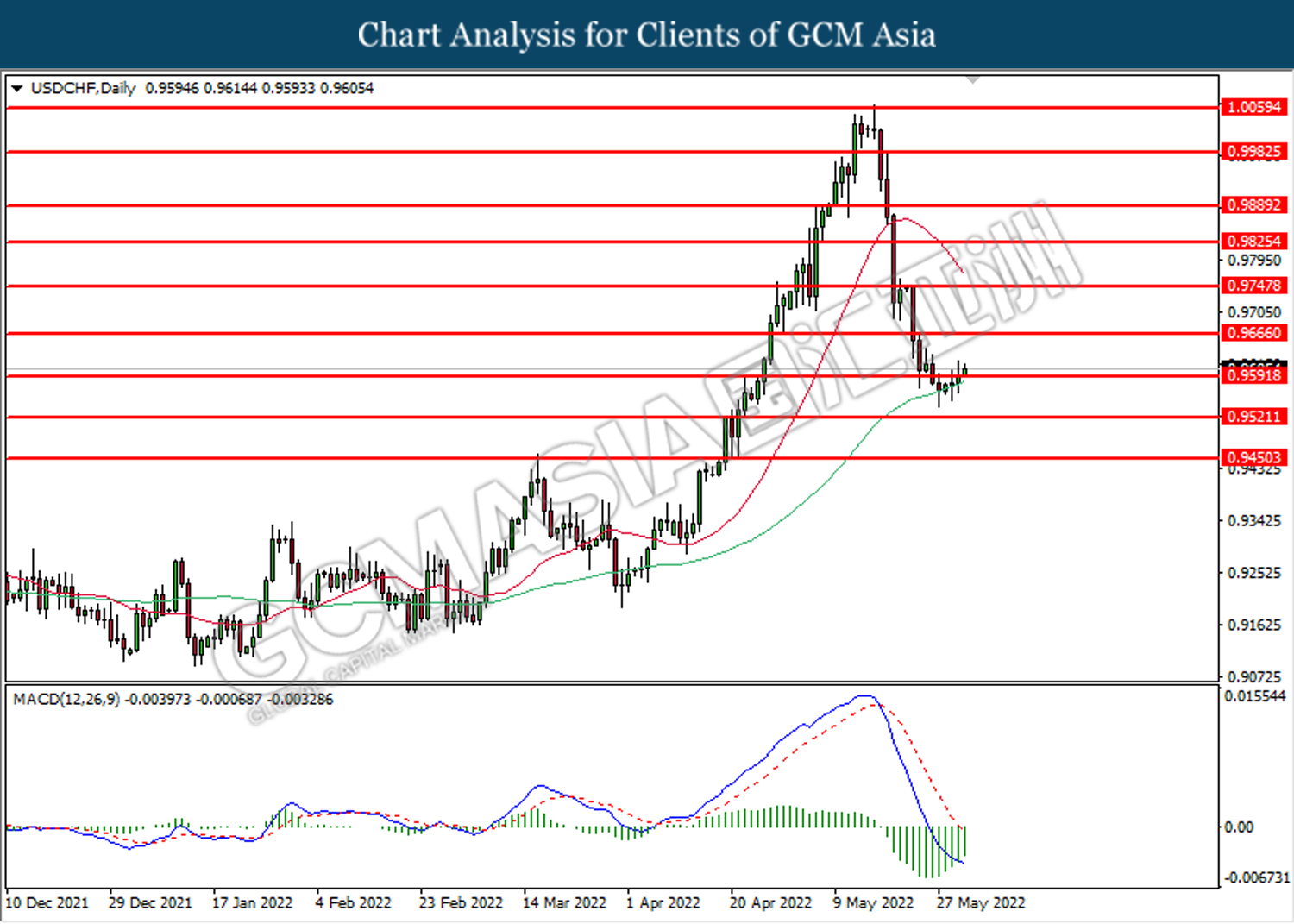

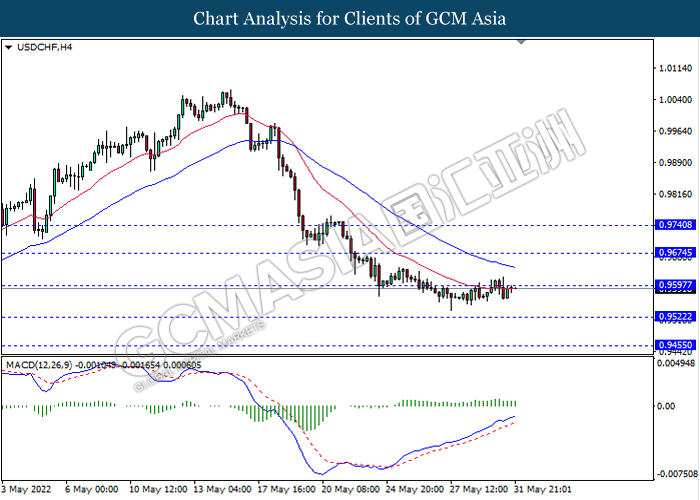

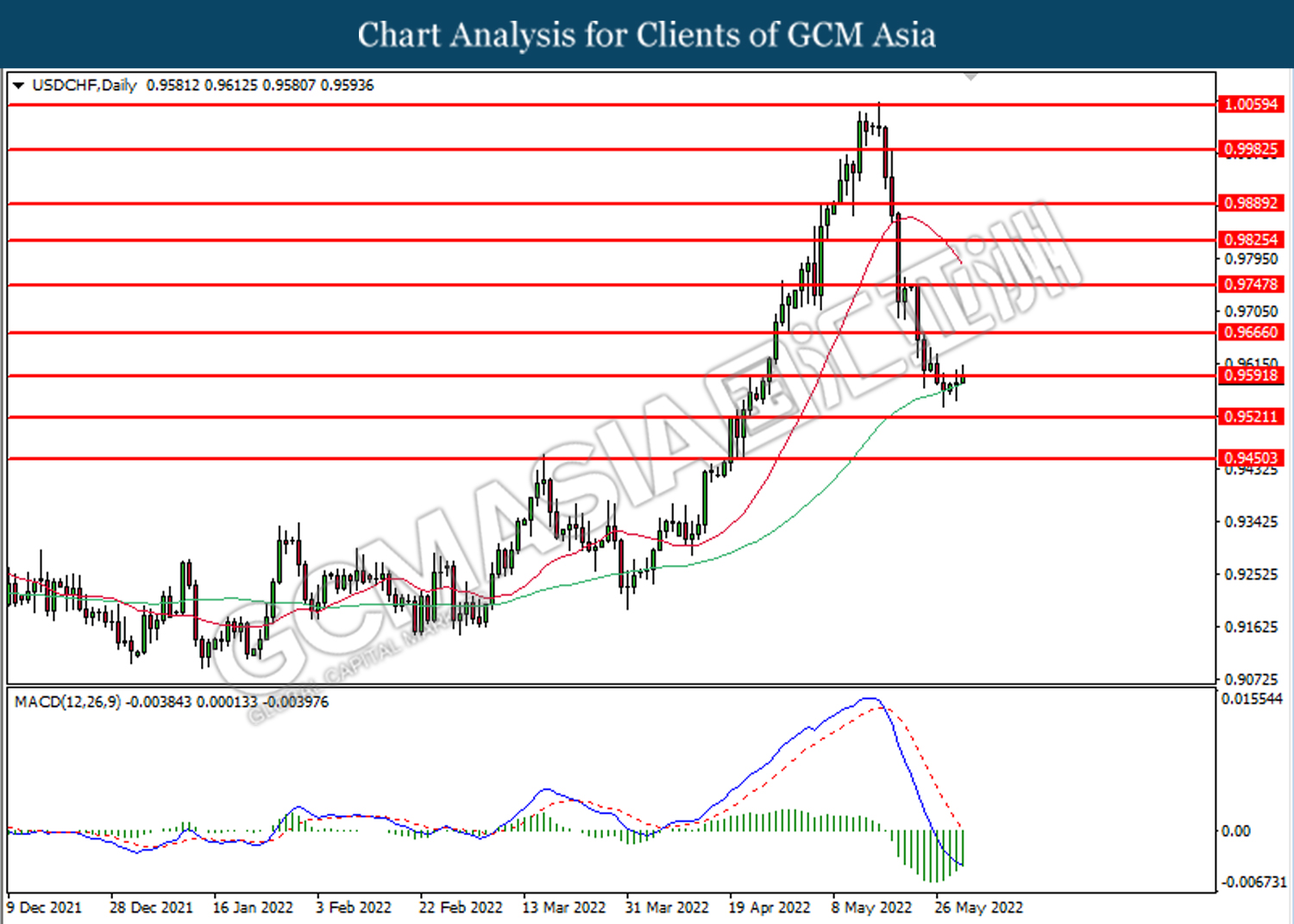

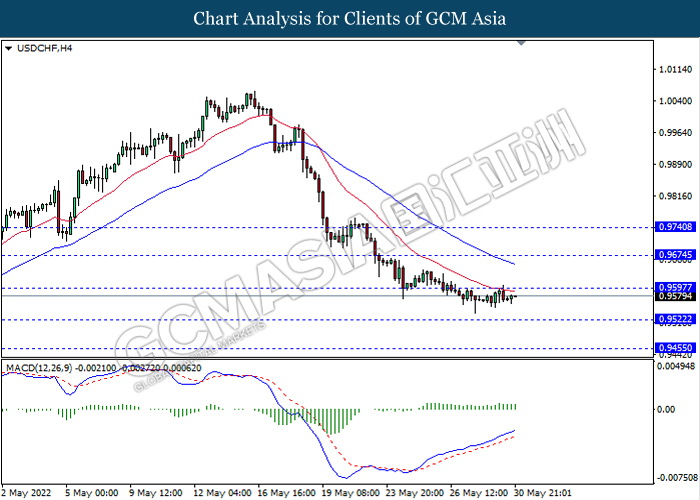

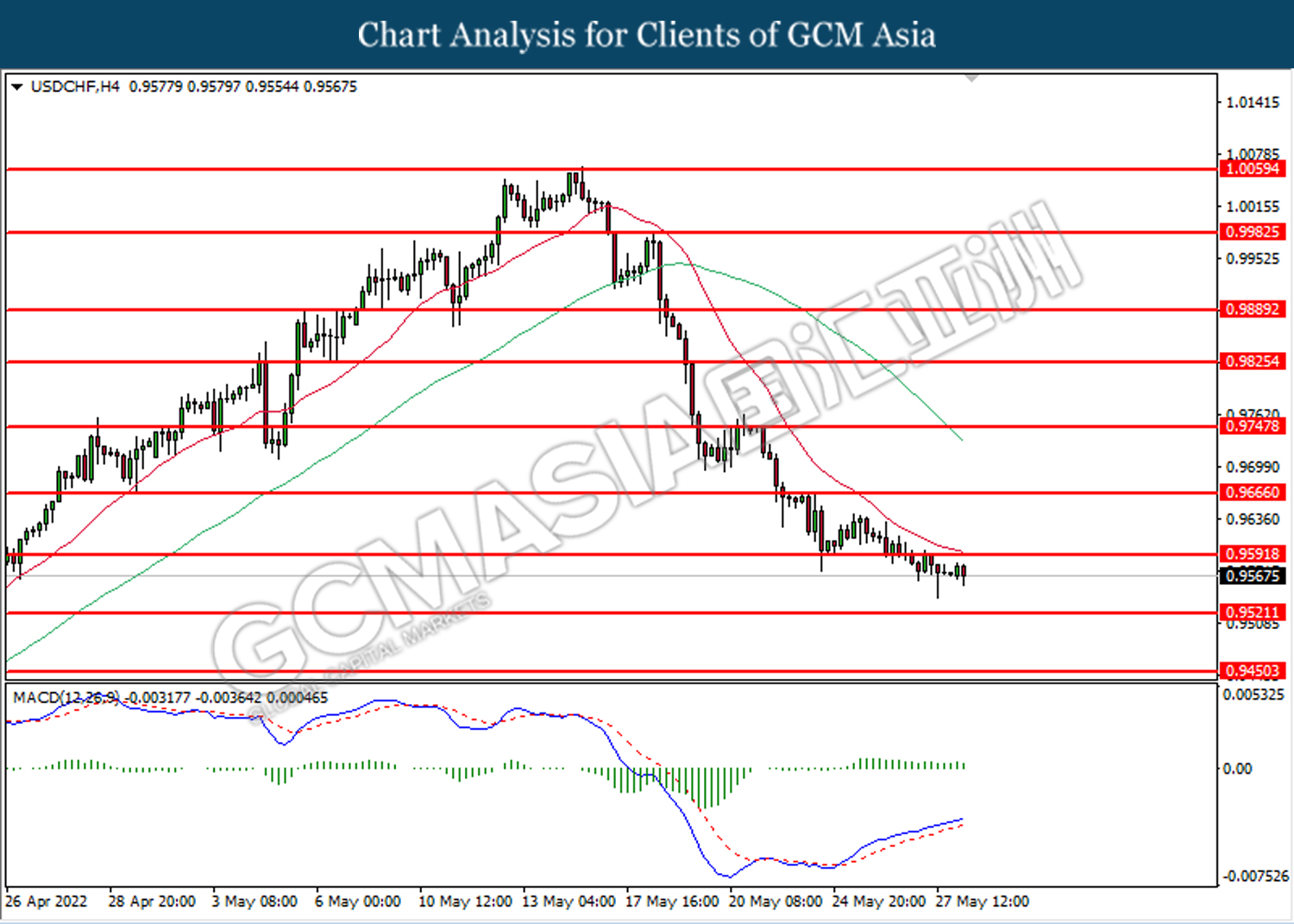

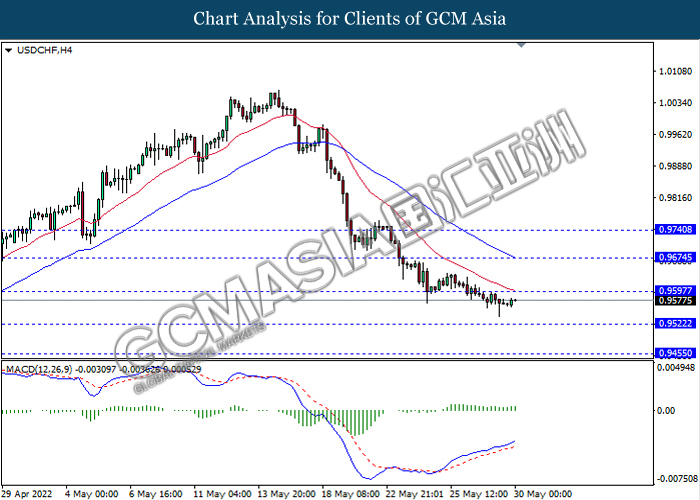

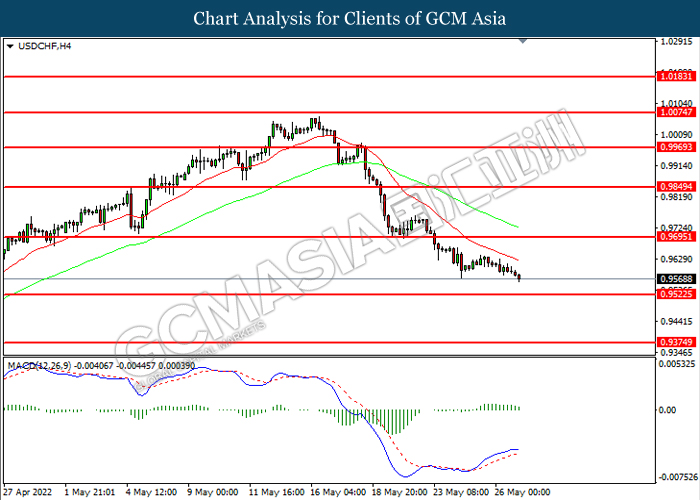

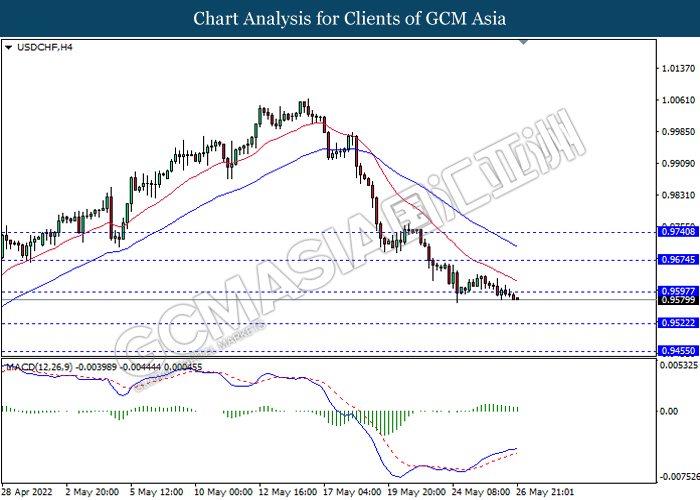

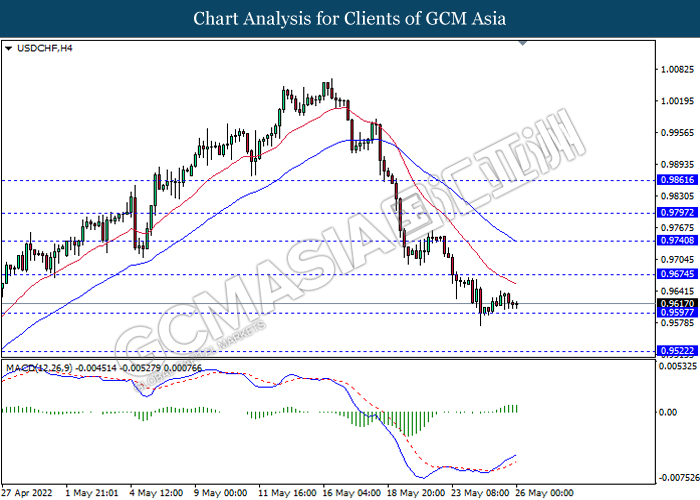

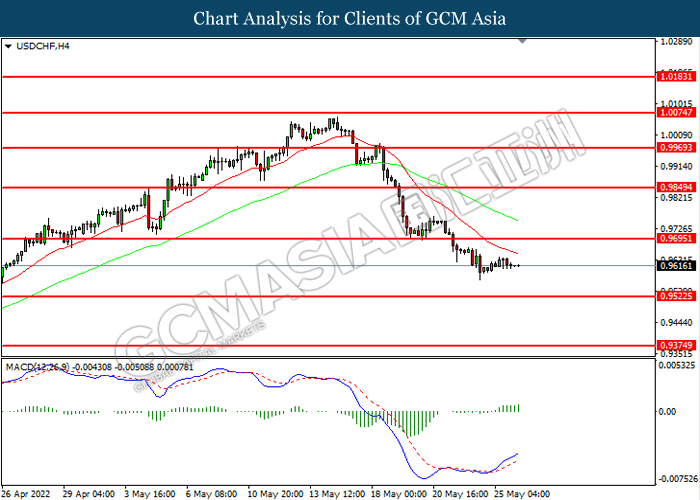

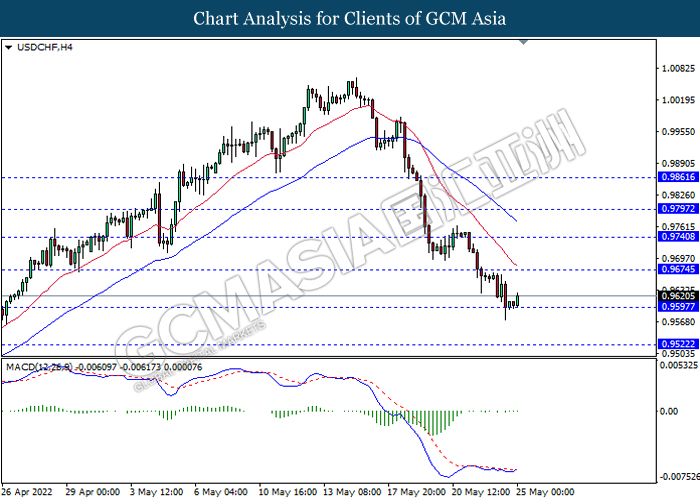

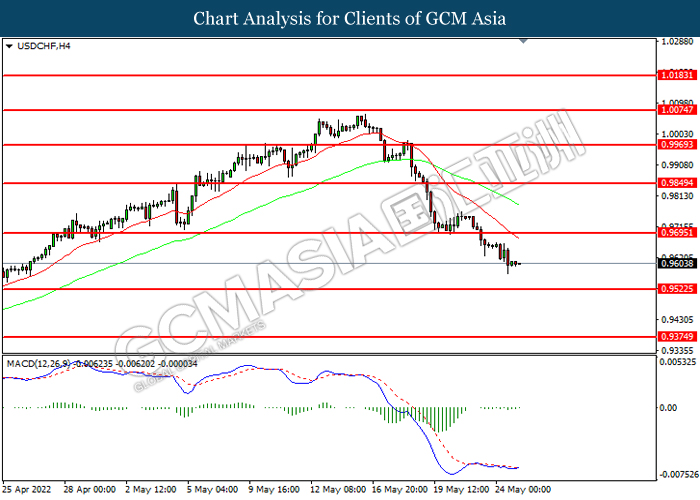

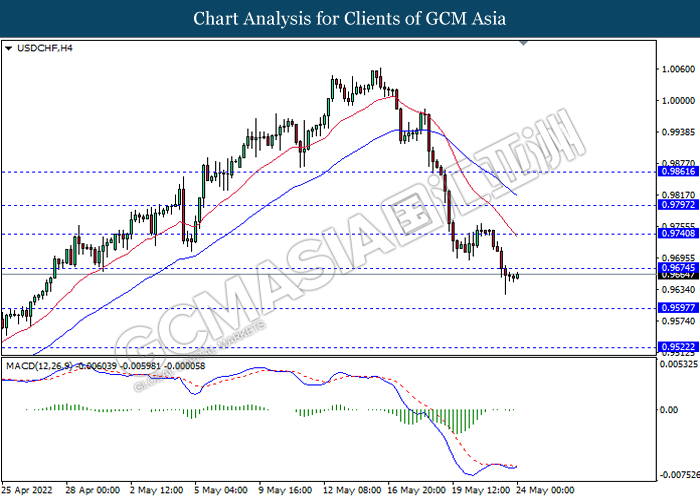

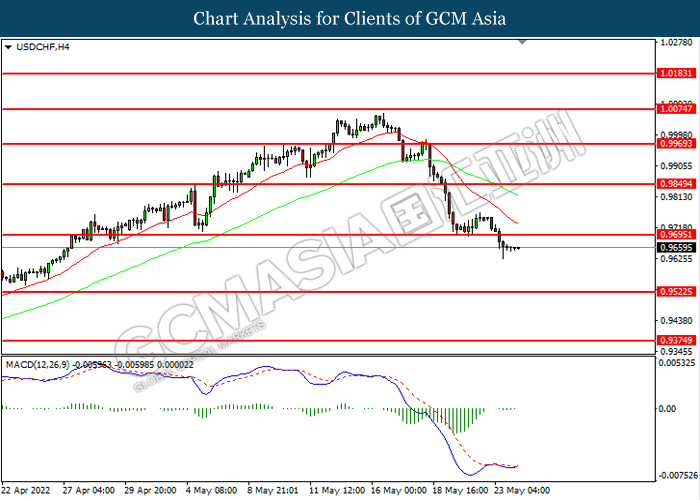

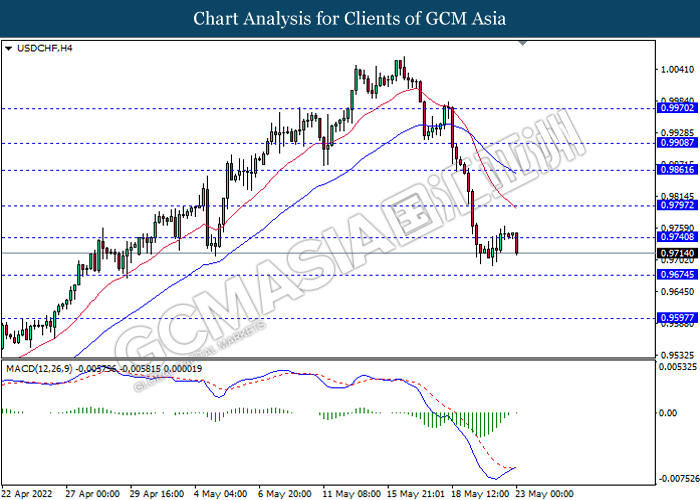

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

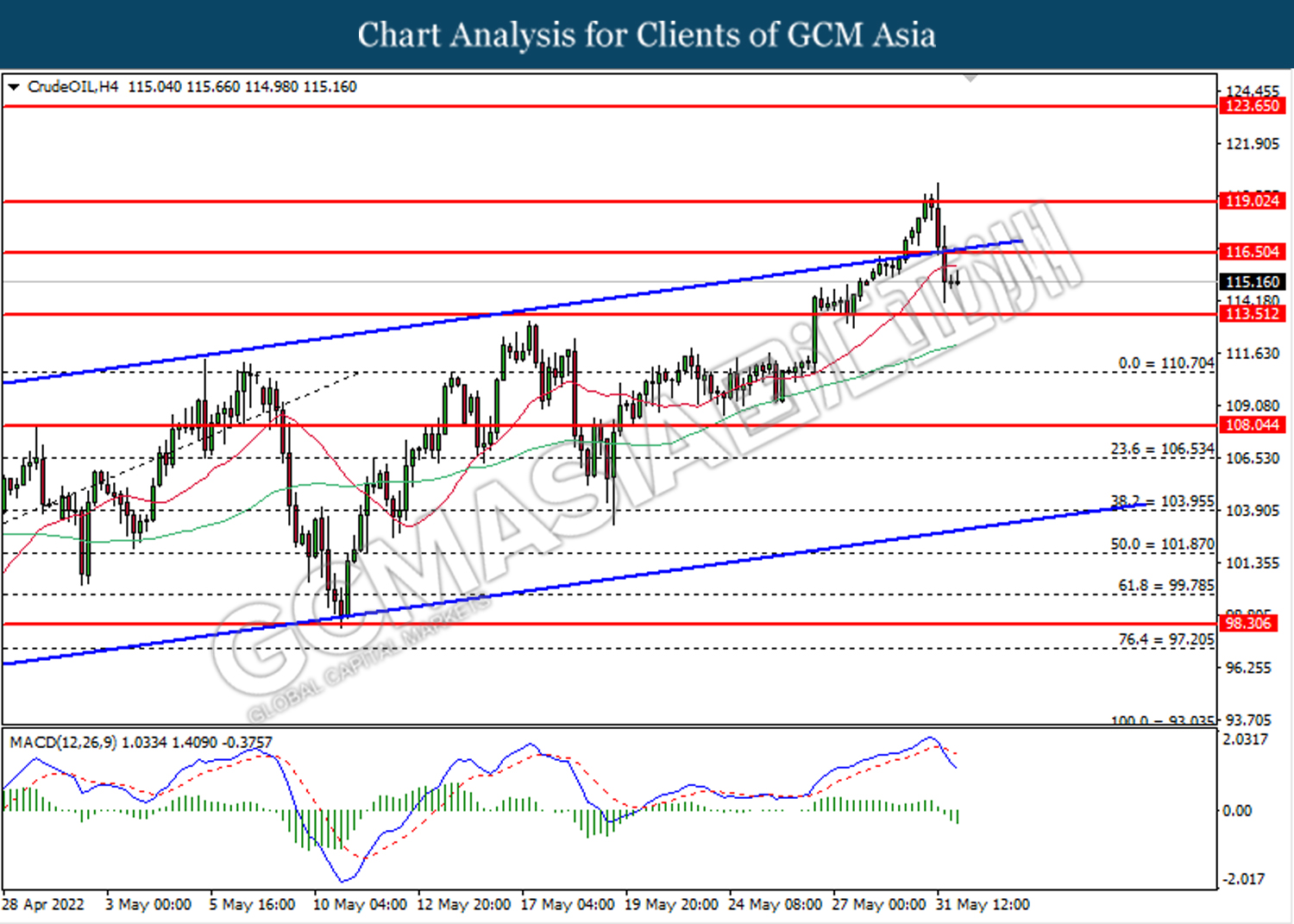

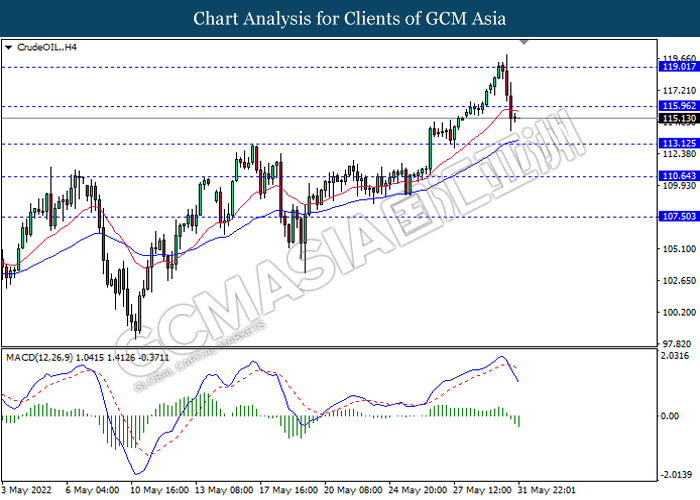

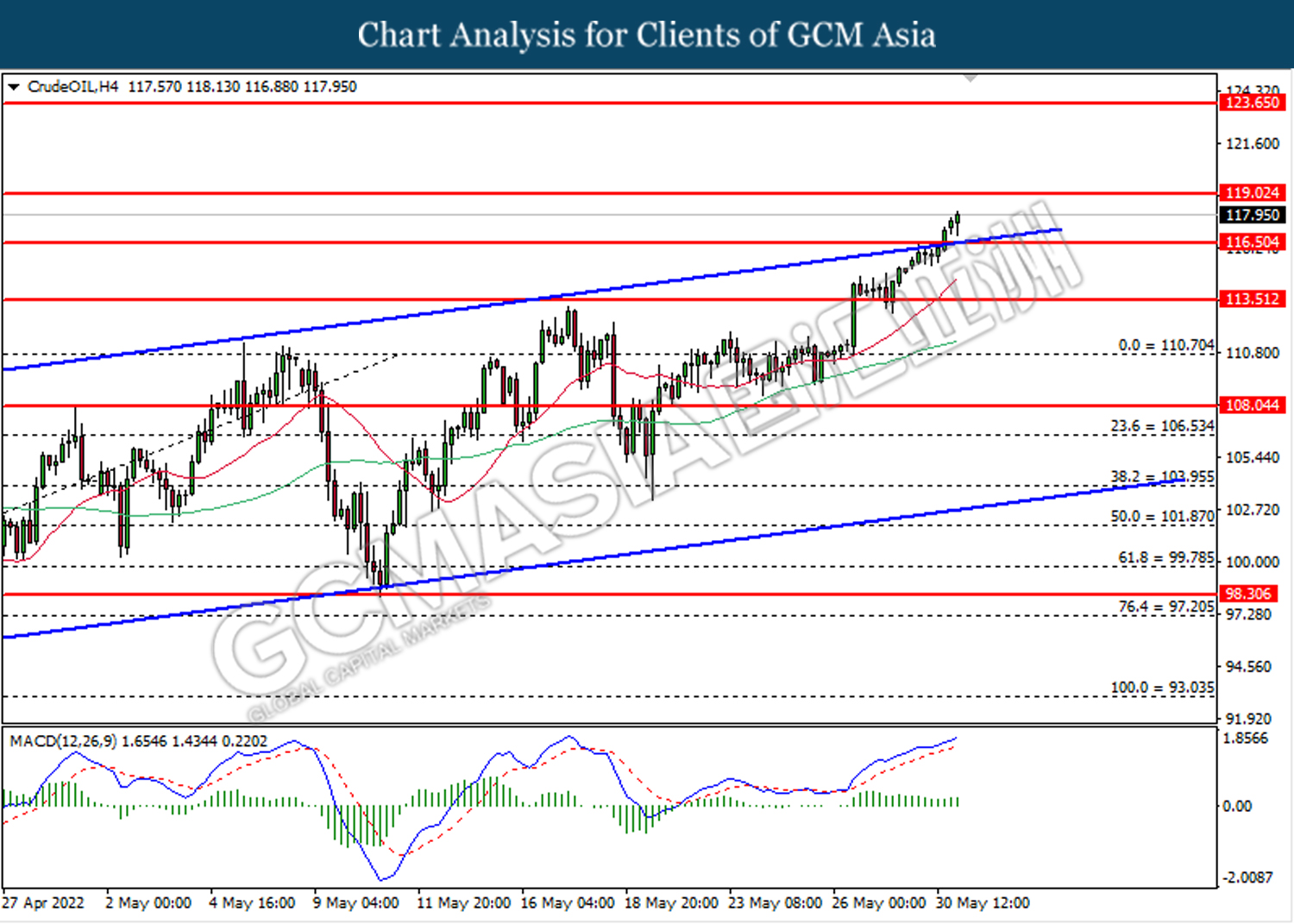

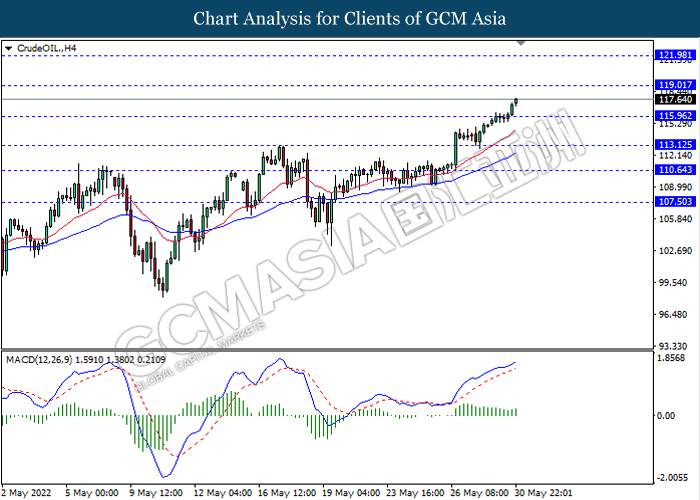

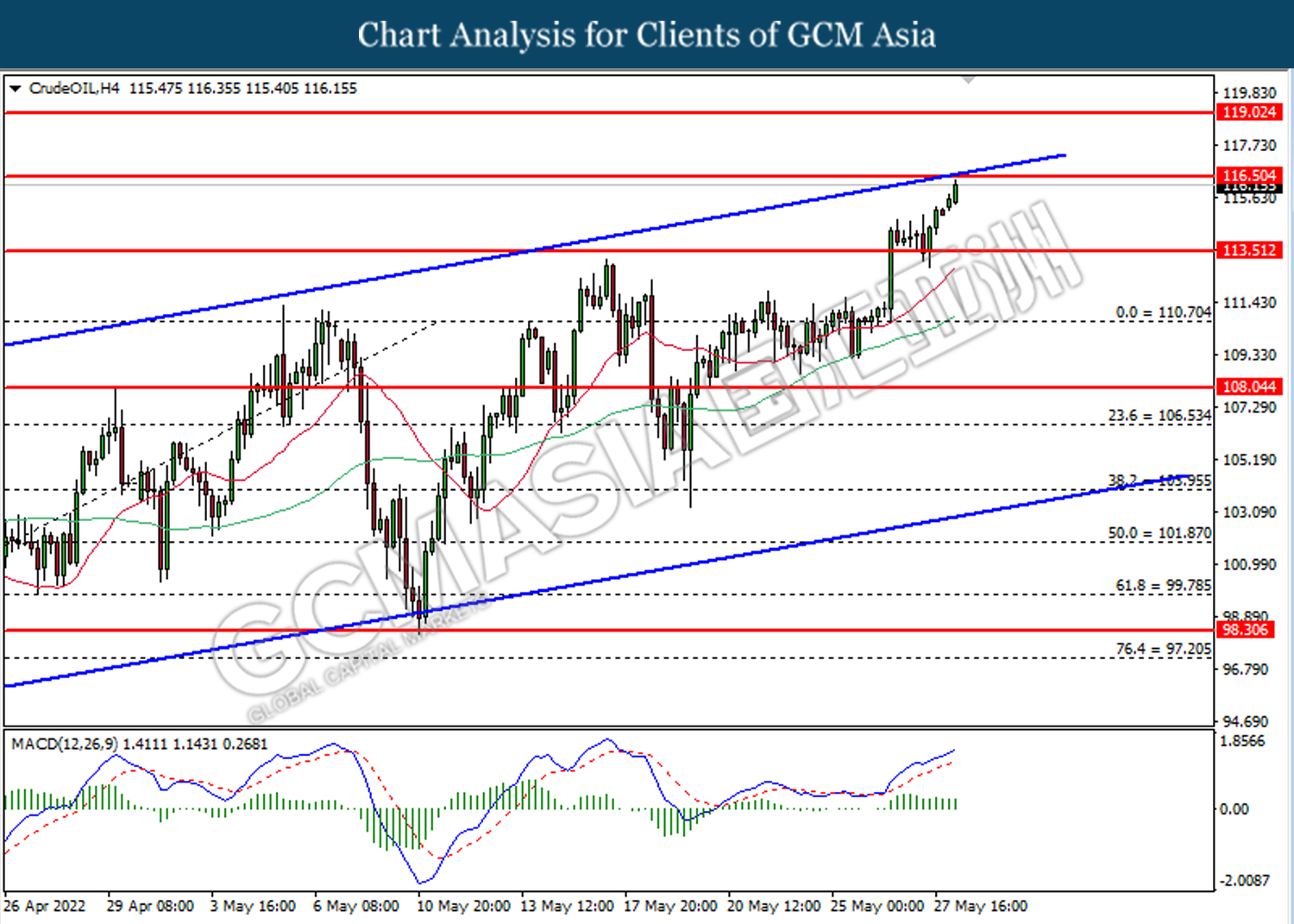

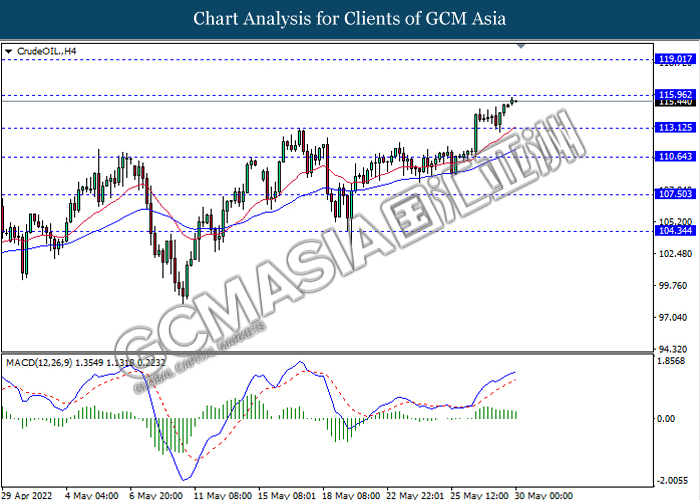

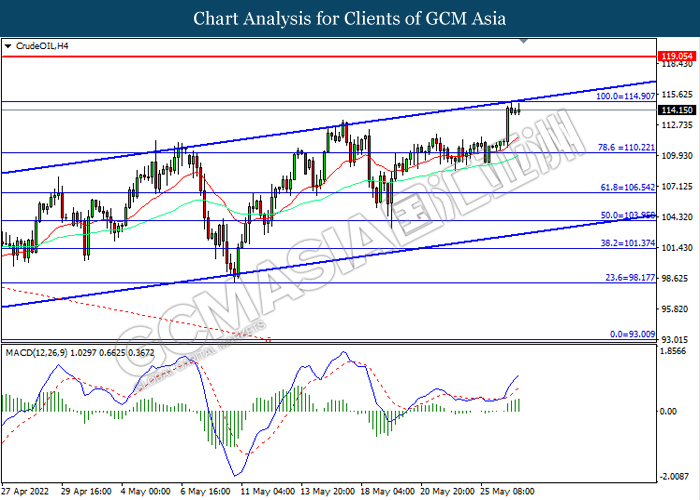

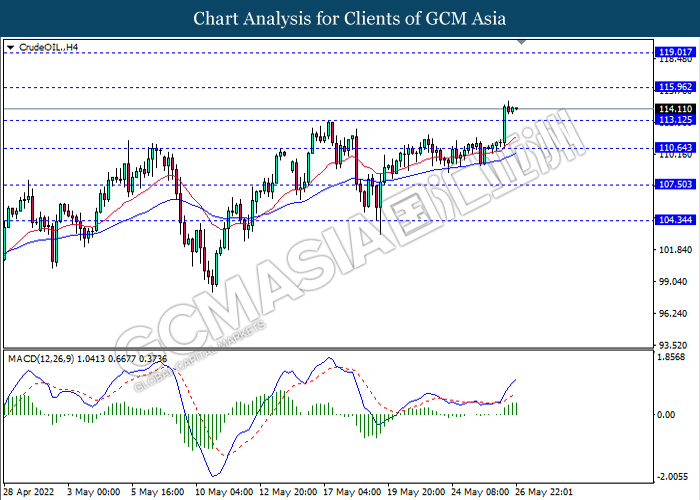

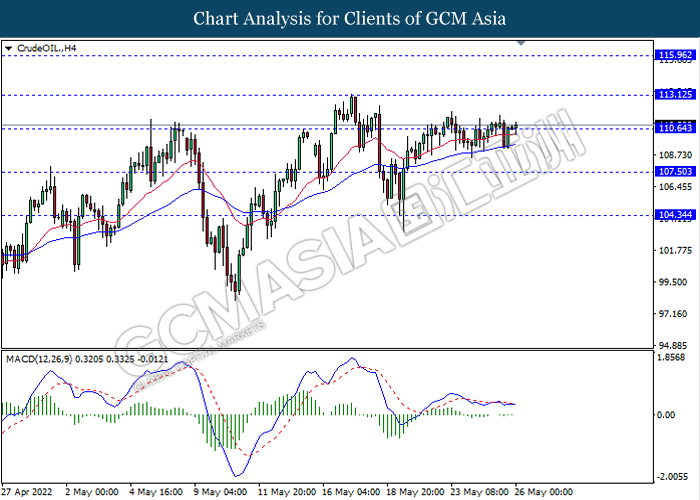

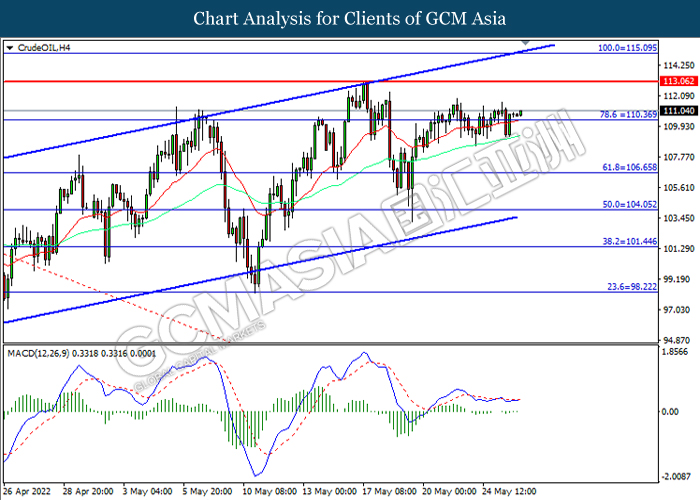

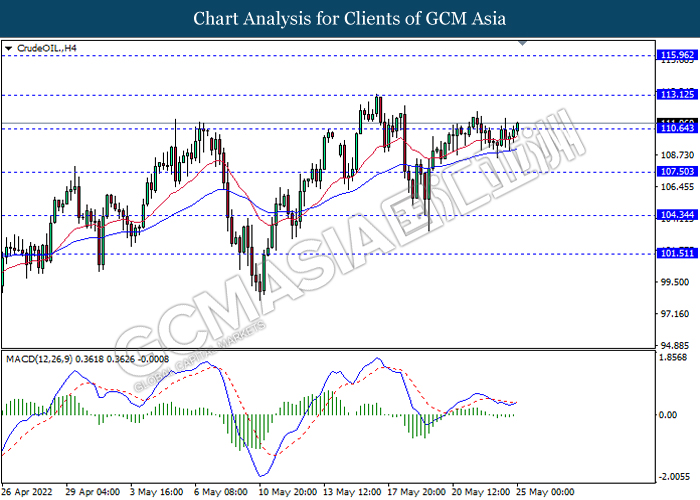

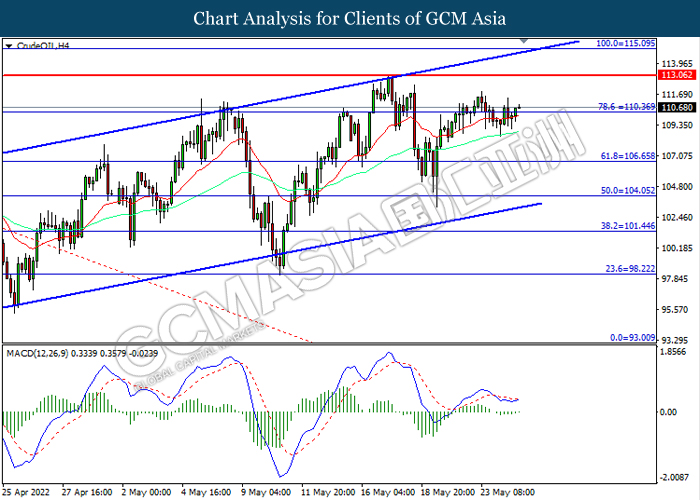

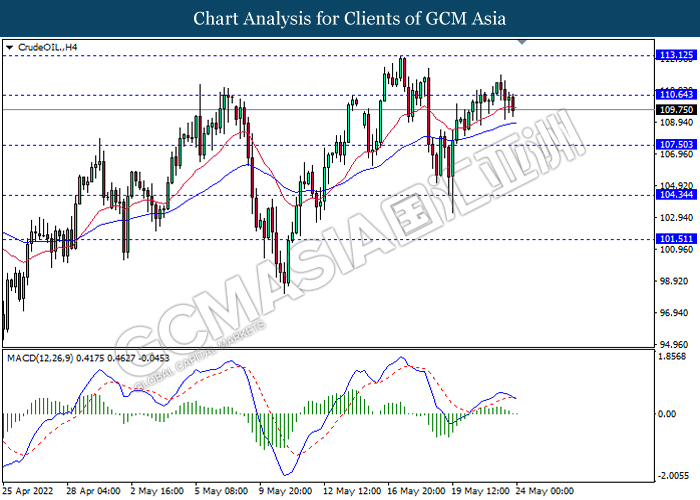

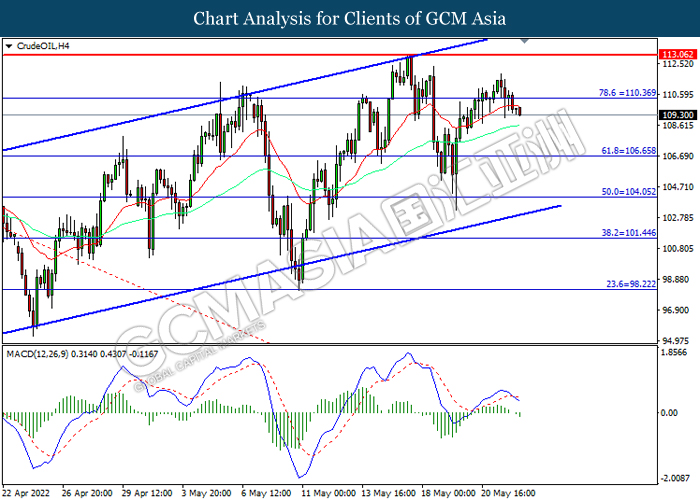

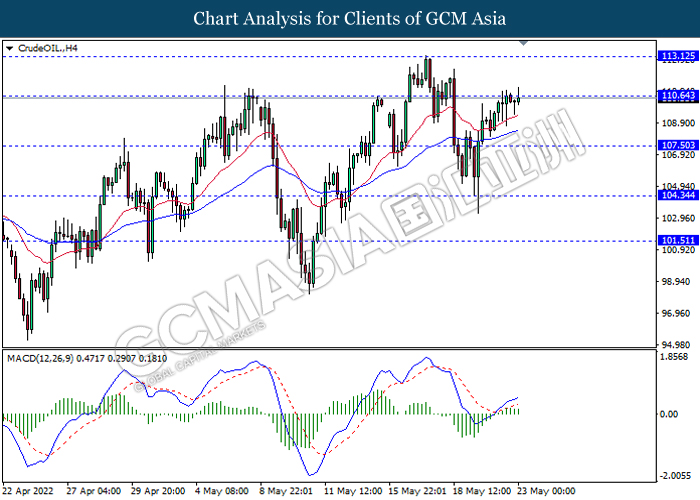

CrudeOIL, H4: Crude oil price was traded lower following prior breakout above the previous support level at 116.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 113.50.

Resistance level: 116.50, 119.00

Support level: 113.50, 110.70

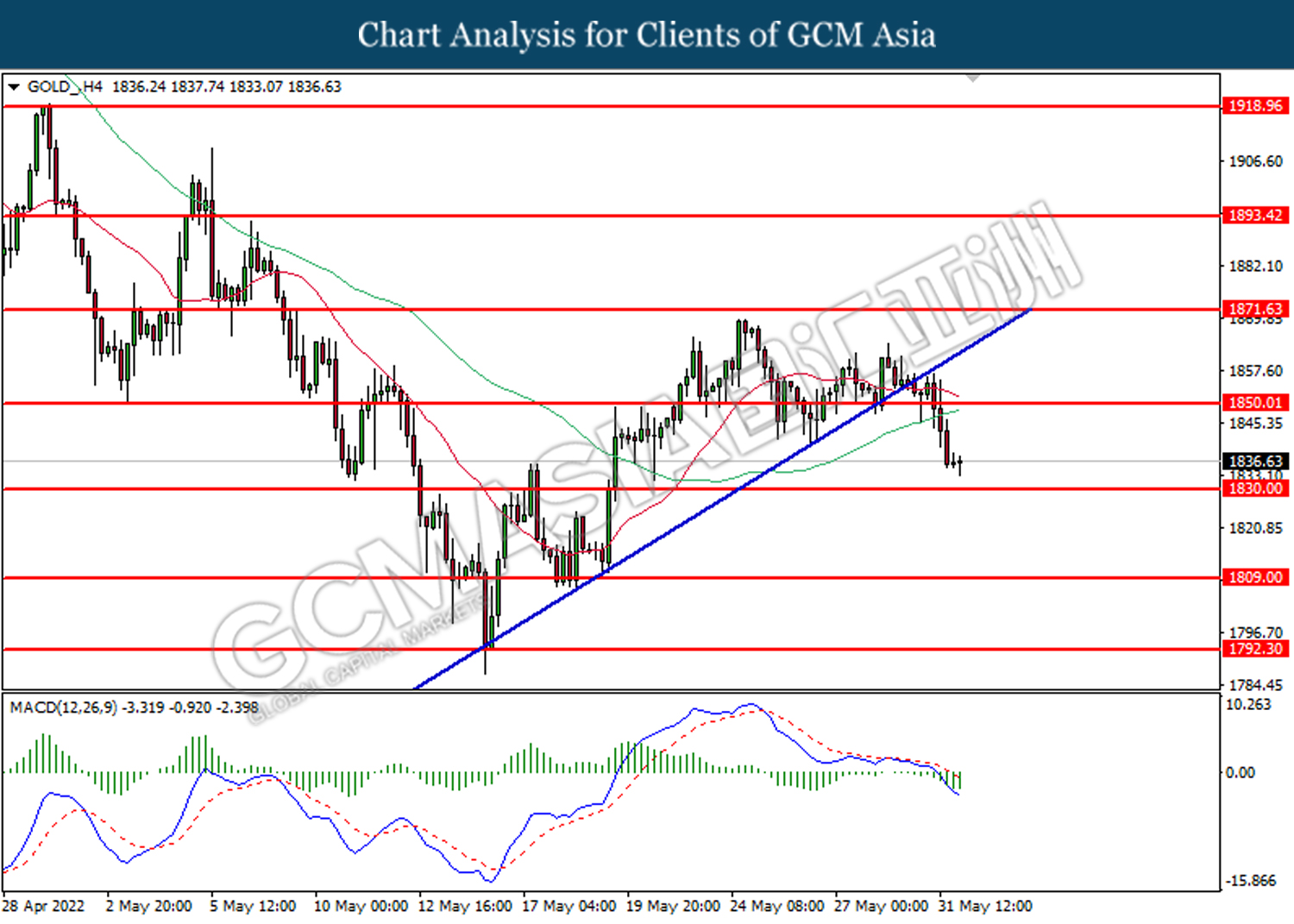

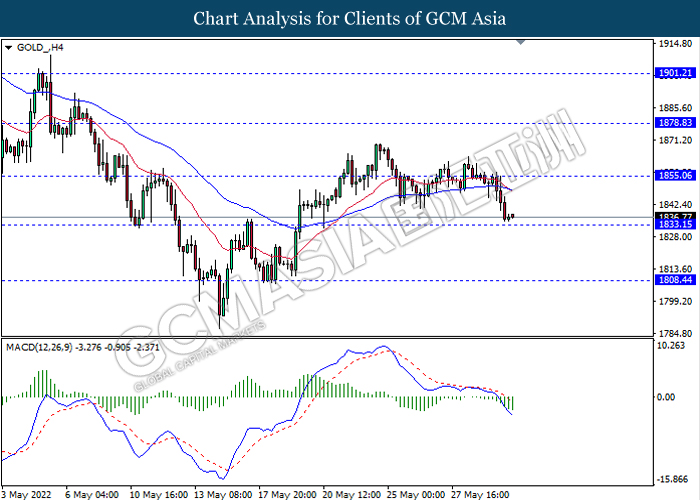

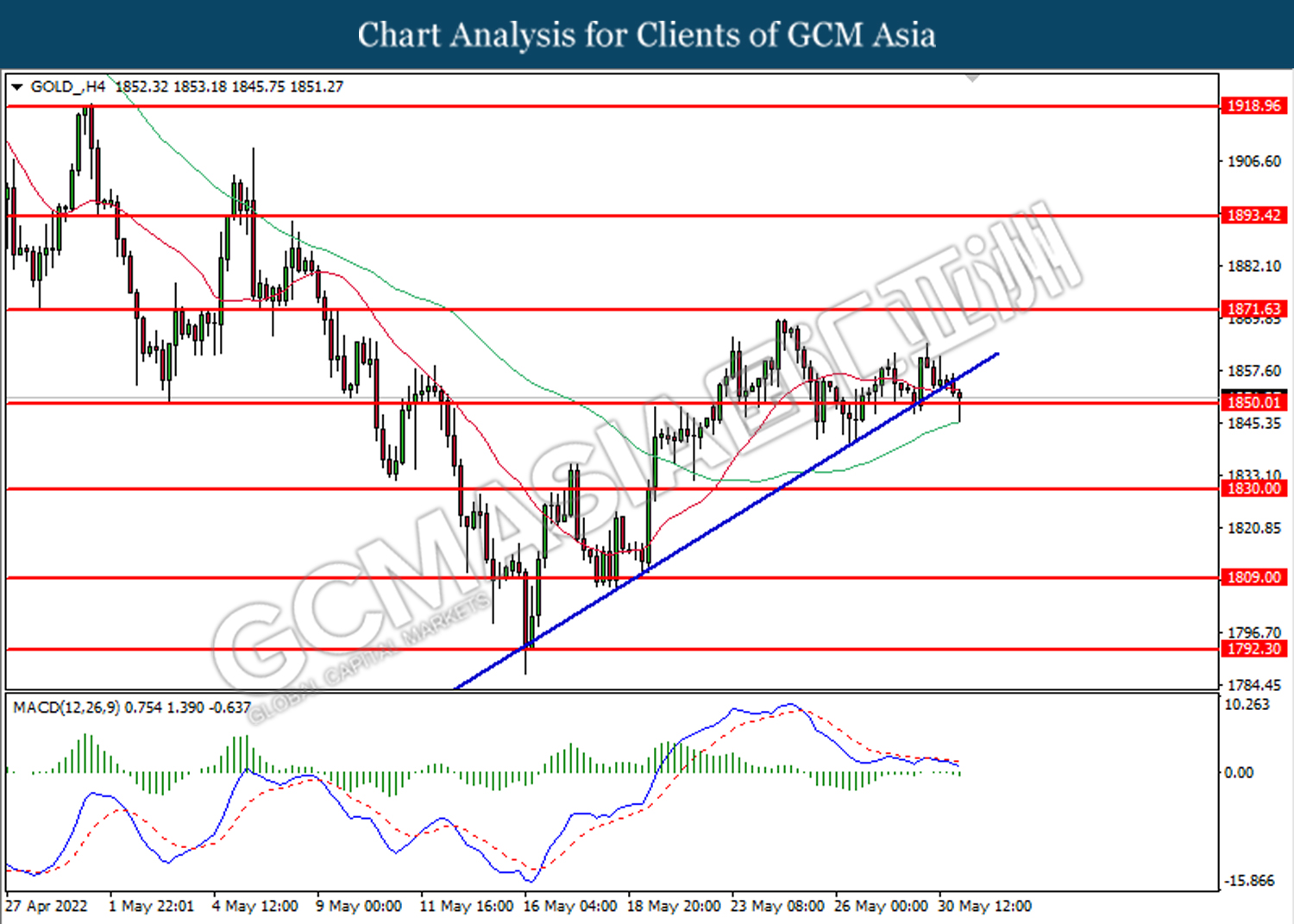

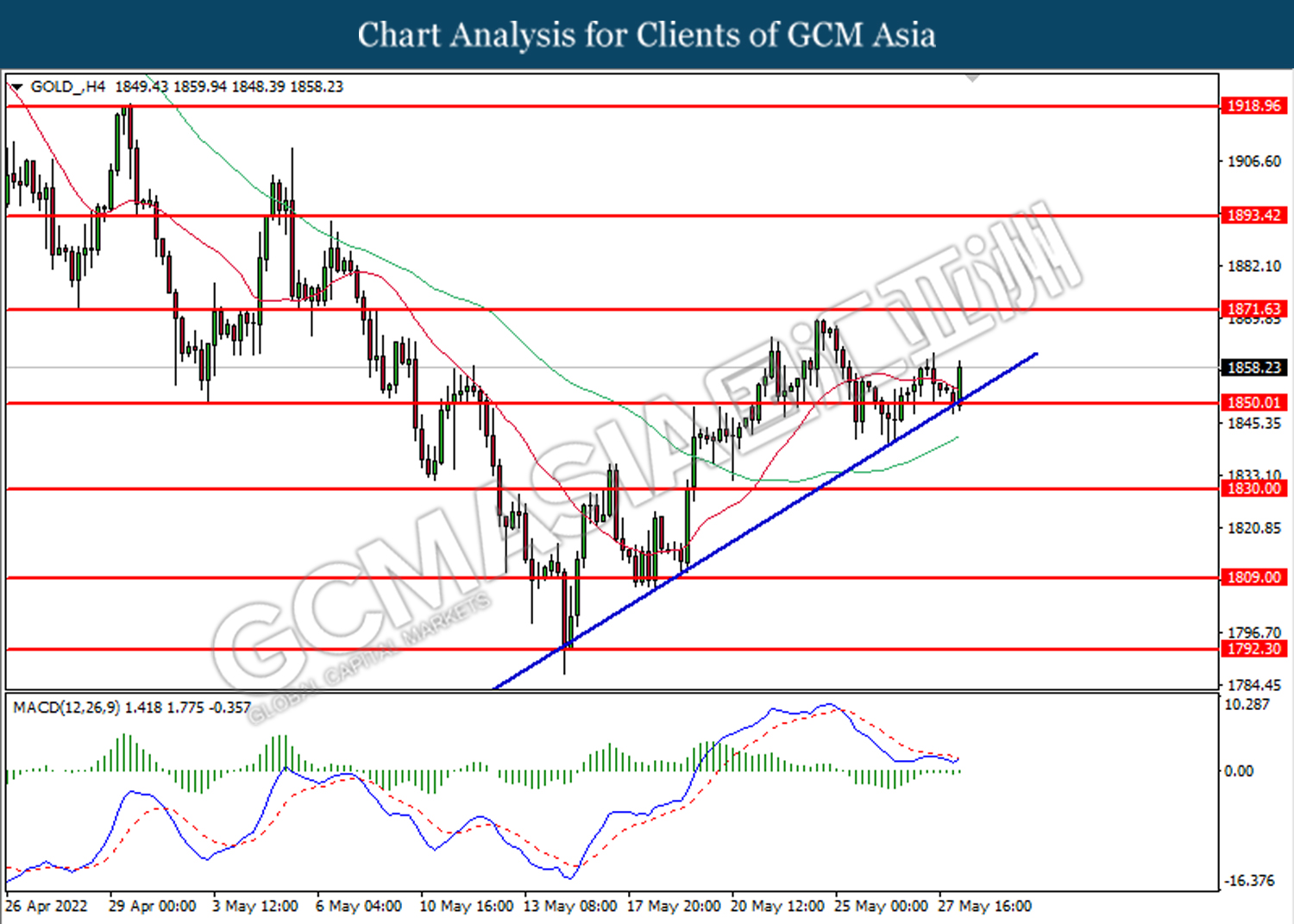

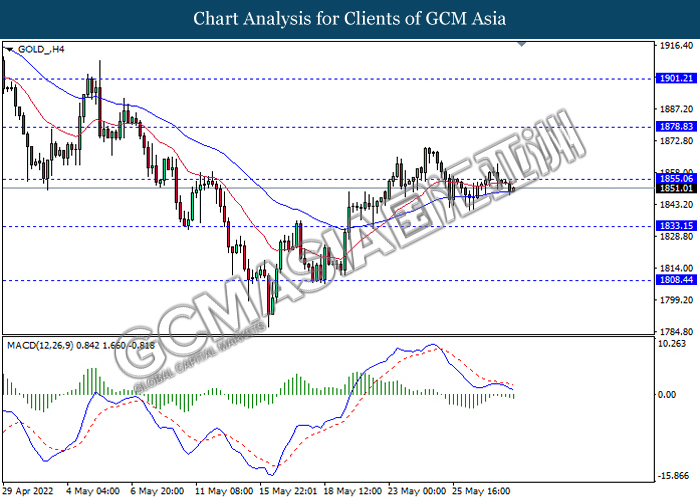

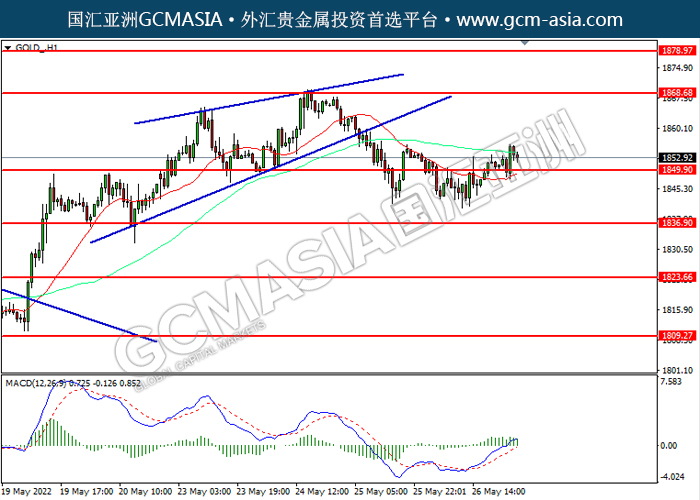

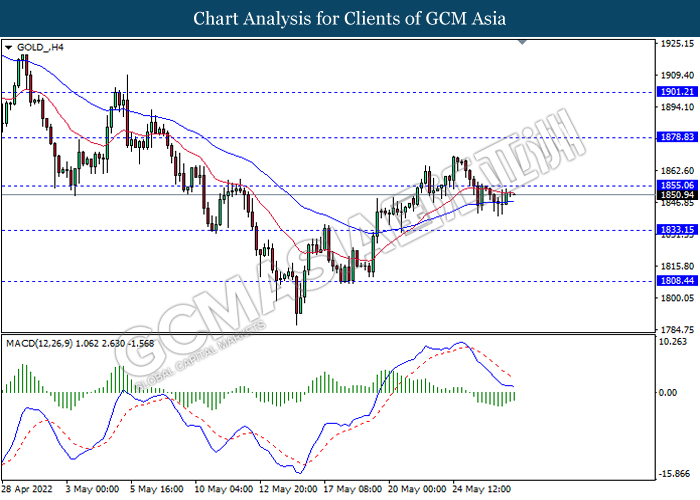

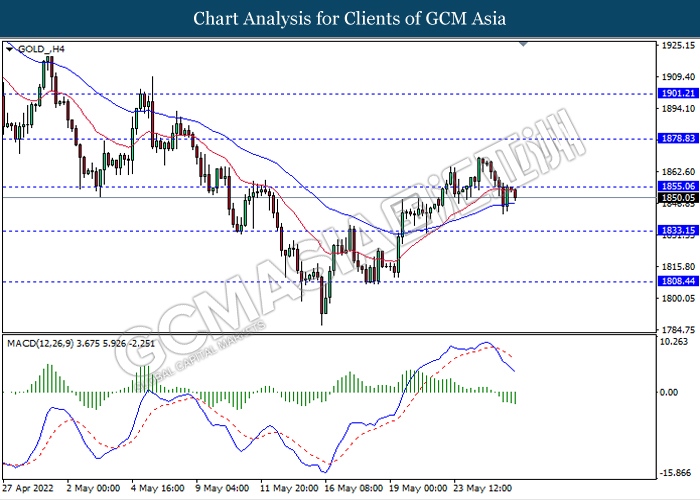

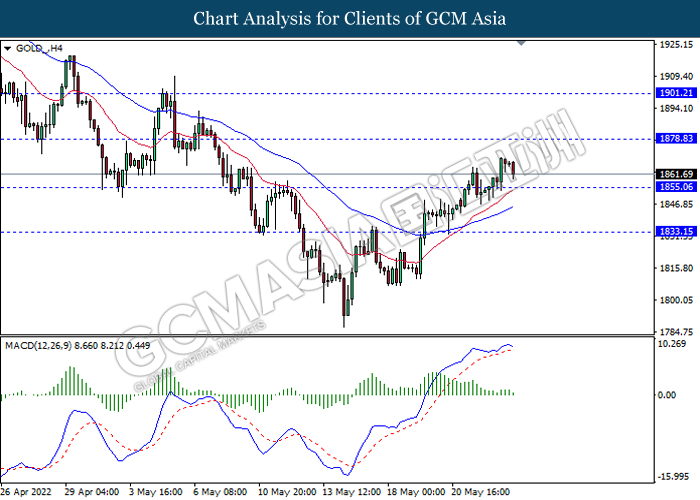

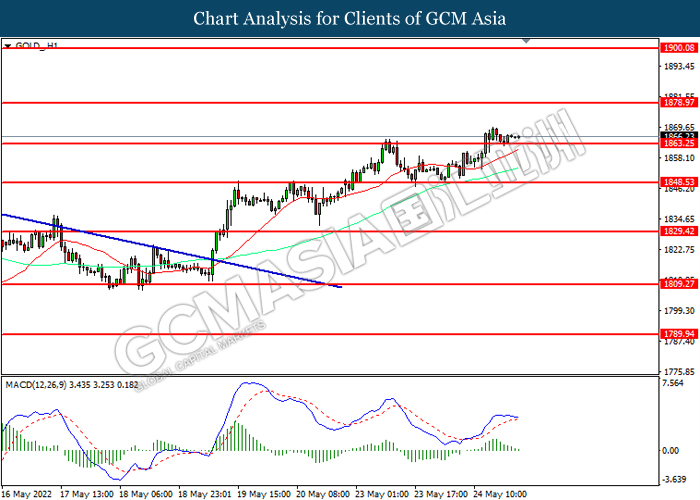

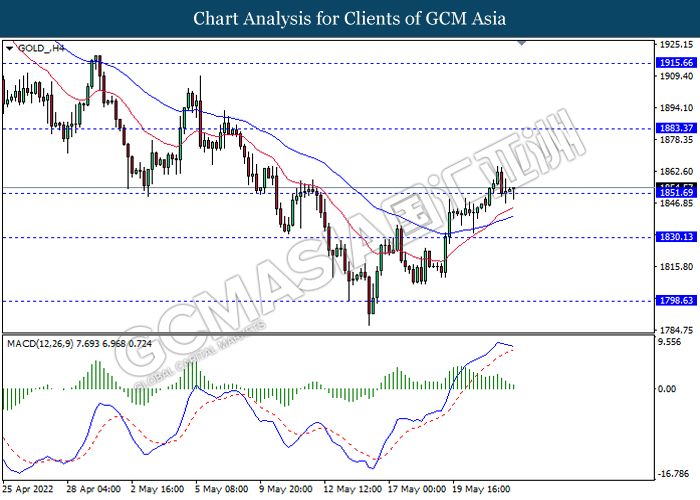

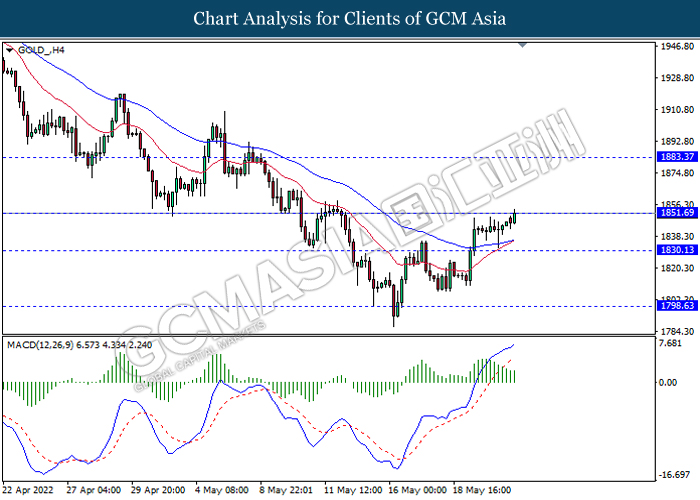

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1850.00. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1830.00.

Resistance level: 1850.00, 1871.65

Support level: 1830.00, 1809.00

010622 Morning Session Analysis

1 June 2022 Morning Session Analysis

US Dollar rallied following the hawkish speech from Joe Biden.

The Dollar Index which traded against a basket of six major currencies surged on Tuesday amid the rising Treasury yield as well as the worries over a further acceleration in global inflation continued to weigh down investors’ risk appetite in the global financial market. The US Treasury Yield received bullish momentum following the US President Joe Biden unleashed hawkish tone toward the monetary policy decision. According to Reuters, President Joe Biden told Fed Chair Jerome Powell on Tuesday that he will give sufficient space and independence for the Federal Reserve to stabilize the inflation rate by aggressive contractionary monetary policy. Besides, the US Dollar extend its gains over the backdrop of upbeat economic data. According to Conference Board, US Conference Board (CB) Consumer Confidence came in at 106.4, exceeding the market forecast at 103.9. The CB Consumer Confidence was used to indicate the confidence level of consumers in economy activities. The higher-than-expected reading indicated that the consumers in US are more willing to spend, dialed up the market optimism toward the economic progression in US. As of writing, the Dollar Index appreciated by 0.49% to 101.80.

In the commodities market, crude oil price rose by 0.46% to $115.22 per barrel as of writing ahead of EU agreed to ban Russian crude oil imports. On the other hand, gold price edged down by 0.48% to $1839.60 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (May) | 54.7 | 54.7 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 54.6 | 54.6 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 300K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 55.4 | 54.5 | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 11.549M | 11.400M | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.00% | 1.50% | – |

Technical Analysis

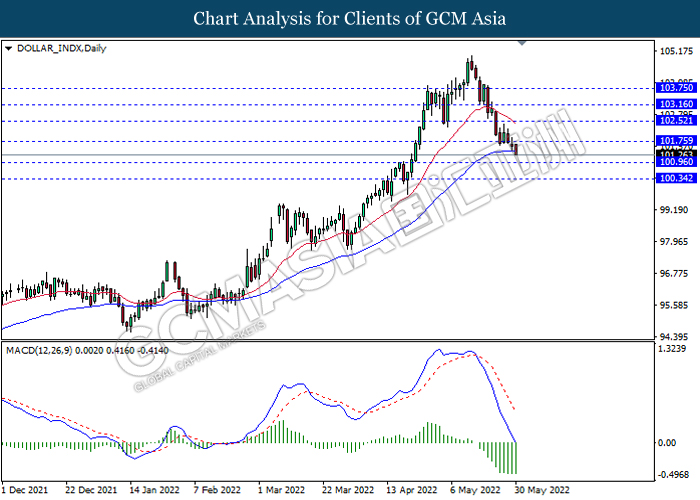

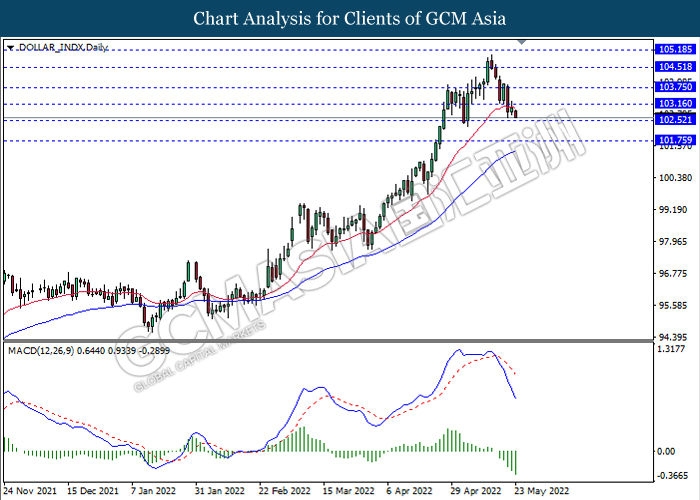

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 101.75, 102.50

Support level: 100.95, 100.35

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6595, 0.6675

Support level: 0.6500, 0.6425

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 115.95, 119.00

Support level: 113.10, 110.65

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45

310522 Afternoon Session Analysis

31 May 2022 Afternoon Session Analysis

Dollar Index slumped amid risk on sentiment heightened.

The US Dollar extends its losses amid the risk-on sentiment in the global financial market, which spurring further bearish momentum on the safe-haven US Dollar. Though, the overall trend for the US Dollar remained stable as US stock and bond markets close for Memorial Day public holiday. The other appeal for the riskier asset Chinese proxy currencies such as Australia and New Zealand Dollar surged significantly following Shanghai emerged further from its Covid-19 lockdown, announcing the resumption of public transport services from 1st June. The authorities also reiterated that the restriction on private cars will be lifted and movement into and out of housing communities will also be allowed on 1st June, except for some residential complexes in medium and high-risk areas. Besides, the authorities in capital Beijing claimed that the Covid-19 outbreak in the region was still under control, after a week of steadily declining case numbers. The announcement of the easing Covid-19 lockdown in China as well as the recent dovish economic data had spurred risk appetite in the global financial market, which diminishing the market demand on the safe-haven US Dollar. As of writing, the dollar index down by 0.01% to 101.65.

In the commodities market, crude oil prices up by 0.64% to $119.20 per barrel as EU has reached a consensus in principle on implementing sanctions toward the oil imported from Russia. Besides, gold prices dropped -0.29% to $1850.85 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (May) | -13K | -16K | – |

| 17:00 | EUR – CPI (YoY) (May) | 7.40% | 7.70% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 1.10% | 0.50% | – |

| 22:00 | USD – CB Consumer Confidence (May) | 107.3 | 103.9 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trendline.

Resistance level: 1.2700, 1.2825

Support level: 1.2585, 1.2425

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its retracement toward the support level at 1.0695.

Resistance level: 1.0770, 1.0660

Support level: 1.0695, 1.0640

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 126.95. MACD which illustrated diminishing bearish momentum suggest the pair to be extend its gains toward the resistance level at 128.80.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6545. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6545.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2660. MACD which illustrated diminishing bearish momentum suggest the pair to extend its rebound toward the resistance level at 1.2715.

Resistance level: 1.2715, 1.2775

Support level: 1.2660, 1.2590

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 116.50. MACD which illustrated bullish momentum suggest the commodity to extend its gains toward the resistance level at 119.00.

Resistance level: 119.00, 123.65

Support level: 116.50, 113.50

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1850.00. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00

310522 Morning Session Analysis

31 May 2022 Morning Session Analysis

Euro rallied ahead of spiking inflation risk in Europe.

The EURUSD extended it gains on Monday over the backdrop of soaring inflation risk in Eurozone. According to Reuters, preliminary data from Germany, the Eurozone’s largest economy, showed price increases ramped up a notch in May, as the impact of last year’s surge in gas prices fed through into broader parts of the economy, while rental prices also rose worryingly. Figures released by the five biggest German federal states showed consumer prices rose by between 0.9% and 1.1%, up from a nationwide average of 0.8% in April and defying expectations for a slight moderation to growth of around 0.5%. In order to combat the inflation, European central Bank (ECB) would likely to implement an aggressive rate hike in the upcoming meetings, which sparkling the appeal of the Euro. Besides, the weakening US Dollar had spurred further bullish momentum on the pair. The US 10-Years Treasury yields slide down to 2.743% on Friday, as a key inflation reading showed a slowing rise in prices. Federal Reserve would less likely to decide an aggressive rate hike as the inflation in US might reach its peak, which dialed down the market optimism toward US Dollar. As of writing, the EURUSD edged down by 0.02% to 1.0775.

In the commodities market, crude oil price appreciated by 0.32% to $117.56 per barrel as of writing following the EU leaders agreed to ban the export of Russian oil to the 27-nation bloc, according to Reuters on Monday. On the other hand, gold price depreciated by 0.06% to $1856.03 per troy ounce as of writing amid the market sentiment toward risk-appetite assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (May) | -13K | -16K | – |

| 17:00 | EUR – CPI (YoY) (May) | 7.40% | 7.70% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 1.10% | 0.50% | – |

| 22:00 | USD – CB Consumer Confidence (May) | 107.3 | 103.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 101.75, 102.50

Support level: 100.95, 100.35

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2710, 1.2790

Support level: 1.2615, 1.2535

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0850, 1.0925

Support level: 1.0770, 1.0685

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to be extend its gains.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6595, 0.6675

Support level: 0.6500, 0.6425

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 119.00, 122.00

Support level: 115.95, 113.10

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45

300522 Afternoon Session Analysis

30 May 2022 Afternoon Session Analysis

Upbeat retail sales spurred the bullish trend in Australian dollar.

The Australian dollar, which is widely traded by the global investors, surged following the release of upbeat economic data from the region. Prior to that, the pair of AUD/USD managed to recoup part of its losses as the possibility of pause in the US rate hike dragged the appeal of dollar index. The bullish momentum of AUD/USD has been extended further after Australian Bureau of Statistics (ABS) released its retail sales data. According to the institution, the Australian retail sales data jumped to another record level in April, where the data came in at 0.9%, similar to the expectation of consensus. Upbeat economic data underscored the recovery of consumer spending in Australia in the post-pandemic period. At this juncture, majority of the investors are eyeing on the upcoming crucial data such as GDP to gauge the further direction of Australian dollar. As of writing, the pair of AUD/USD rose 0.22% to 0.7175.

In the commodities market, crude oil prices are up by 0.83% to $116.15 per barrel as of writing as the start of driving season in the United States is expected to boost the overall demand for the oil products. Besides, gold price up 0.23% to $1,858.90 per troy ounce amid the weakness of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Memorial Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to be traded lower toward a lower level.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2585. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.2700.

Resistance level: 1.2700, 1.2825

Support level: 1.2585, 1.2425

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0660

Support level: 1.0695, 1.0640

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be extend its gains toward the resistance level at 128.80.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. However, MACD which illustrated bullish momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6520. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6595.

Resistance level: 0.6595, 0.6715

Support level: 0.6520, 0.6430

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2715. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2775, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9590. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9520.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 116.50. MACD which illustrated bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 116.50.

Resistance level: 116.50, 119.00

Support level: 113.50, 110.70

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1850.00. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1871.65.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00

300522 Morning Session Analysis

30 May 2022 Morning Session Analysis

US Dollar dropped as US Treasury yields slumped.

The Dollar Index which traded against a basket of six major currencies edged down on Friday amid the easing of US Treasury yields. According to CNBC, the US 10-Years Treasury yields slide down to 2.743% on Friday, as fears over the Federal Reserve’s plans to aggressively hike interest rates appeared to ease and a key inflation reading showed a slowing rise in prices. The reducing treasury yields would likely to diminish the risk-off return of investors, which dragged down the appeal of US Dollar. Besides, although inflation continued to increase in April, it rose less than in recent months, according to the data showed on Friday. The Personal Consumption Expenditures (PCE) price index rose 0.2%, the smallest gain since November 2020, after shooting up 0.9% in March. For the 12 months through April, the PCE price index advanced 6.3% after jumping 6.6% in March. As the inflation might reach its peak, Federal Reserve would less likely to implement aggressive rate hike in order to combat the easing inflation, which prompted investors to shift their capitals toward risk-appetite assets. As of writing, the Dollar Index appreciated by 0.01% to 101.71.

In the commodities market, crude oil price appreciated by 0.57% to $115.72 per barrel as of writing ahead of the US driving season which led to the increasing demand on oil. On the other hand, gold price depreciated by 0.25% to $1846.68 per troy ounce as of writing following the shift sentiment on the risk-appetite assets.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Memorial Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 101.75, 102.50

Support level: 100.95, 100.35

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2710, 1.2790

Support level: 1.2615, 1.2535

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to be extend its gains.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6595, 0.6675

Support level: 0.6500, 0.6425

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 115.95, 119.00

Support level: 113.10, 110.65

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45

270522 Afternoon Session Analysis

27 May 2022 Afternoon Session Analysis

Antipodean surged amid risk-on sentiment in global financial market.

The riskier asset such as the antipodeans (Australia and New Zealand Dollar) surged significantly amid the risk-on sentiment in the global financial market following the bearish economic data eased the rate hike fears from Fed. The US 10-year Treasury yield retreated on yesterday, spurring further bullish momentum on the equity market. Besides, the Chinese-proxy antipodeans extend its gains following the Chinese authorities has pledged to implement expansionary fiscal policy to boost up the economic momentum in China. According to Aljazeera, Beijing will increase annual tax cuts by more than 140 billion yuan to 2.64 trillion yuan, offer tax rebates to more crucial economic sectors. Other measures include 150 billion yuan in emergency bond for aviation sector and another issuance of 300 billion yuan in bonds to fund railway constructions and new projects in energy, transport and water conservation. As of writing, AUD/USD increased by 0.56% to 0.7137 while NZD/USD surged 0.60% to 0.6515.

In the commodities market, the crude oil price extends its gains by 0.02% to $114.20 per barrel as of writing. The oil market edged higher amid investors speculated that the European Commission (EU) would continue to seek unanimous support for its proposed new sanction against Russia. On the other hand, the gold price appreciated by 0.14% to $1853.10 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Apr | -0.3% | 0.3% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2745, 1.2830

Support level: 1.2620, 1.2500

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0815, 1.0925

Support level: 1.0660, 1.0585

USDJPY, H4: USDJPY was traded within a range while currently near the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 127.20, 129.10

Support level: 125.30, 123.50

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7260, 0.7345

Support level: 0.7115, 0.6995

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

USDCHF, H4: USDCHF was traded lower while currently near the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it breakout the resistance level.

Resistance level: 114.90, 119.05

Support level: 110.20, 106.55

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1868.70, 1878.95

Support level: 1849.90, 1836.90

270522 Morning Session Analysis

27 May 2022 Morning Session Analysis

Downbeat economic data unleashed, US Dollar slumped.

The Dollar Index which traded against a basket of six major currencies eased on Thursday after the downbeat economic data was unleashed. According to Bureau of Economic Analysis, the US Gross Domestic Product (GDP) QoQ notched down from the previous reading of -1.4% to -1.5%, which lower than the market forecast of -1.3%. Besides, the US Pending Home Sales MoM came in at the reading of -3.9%, missing the market forecast of -2.0%, according to National Association of Realtors. Both data which lower than expected reading indicated that the economy recession in the US region, which dialed down the market optimism toward the economic progression in the US. Furthermore, the Dollar Index extended its losses over the slowing rate hike consideration from Federal Reserve. According to Reuters, markets are expecting whether the Federal Reserve might slow or even pause its tightening cycle in the second half of the year, which would weaken the allure of the safe-haven Dollar. As of writing, the Dollar Index depreciated by 0.30% to 101.77.

In the commodities market, crude oil price surged by 0.18% to $114.30 per barrel as of writing on signs of tight supply ahead of the US summer driving season, as the European Union wrangled with Hungary over plans to ban crude imports from Russia over its invasion of Ukraine. On the other hand, gold price appreciated by 0.20% to $1851.21 per troy ounce as of writing following the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Apr) | 0.3% | 0.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains id successfully breakout the resistance level.

Resistance level: 127.20, 128.00

Support level: 126.25, 125.10

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 115.95, 119.00

Support level: 113.10, 110.65

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45

260522 Afternoon Session Analysis

26 May 2022 Afternoon Session Analysis

Euro rallied amid the ECB hawkish speech.

The Euro rebounded from its recent low on Thursday amid the backdrop of the European Central Bank (ECB) hawkish tone. According to CNBC, ECB President Christine Lagarde had claimed that the ECB could increase rates in July and “be in a position to exit negative interest rates by the end of the third quarter.” The rate hike implementation from ECB would likely to increase the risk-off return of investors, sparkling the appeal of Euro. Besides, the slump of US Dollar had spurred further bullish momentum on the EURUSD. According to CNBC, Federal Reserve officials appeared a statement on FOMC meetings early today, which claimed that the need to raise interest rates quickly and possibly more than markets anticipate to tackle a burgeoning inflation problem. Not only did policymakers see the need to increase benchmark borrowing rates by 50 points, but they also said similar hikes likely would be necessary at the next several meetings. Despite Fed unleashed its speech which it would increase interest rate in future, the market participants had digested the information as the rate hike implementation was within market expectation, which prompting investors to invest in other currencies which having better prospects such as Euro. As of writing, EURUSD appreciated by 0.21% to 1.0701.

In the commodities market, crude oil price edged up by 0.55% to $110.94 per barrel as of writing following the tight supply concern of the European Union (EU) wrangles with Hungary over plans to ban imports from Russia. On the other hand, gold price appreciated by 0.19% to $1849.20 per troy ounces as of writing over the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | -1.4% | -1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 218K | 213K | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | 2.1% | 2.0% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Apr) | -1.2% | -1.9% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45

260522 Morning Session Analysis

26 May 2022 Morning Session Analysis

US Dollar slumped as Fed meeting minutes aligned with market expectation.

The Dollar Index which traded against a basket of six major currencies retreated following the released of the FOMC meeting minutes from Federal Reserve. The Federal Reserve policymakers agreed that the Fed should act “expeditiously” on their contractionary monetary policy to combat the spiking inflation rate in short-term basis. Nonetheless, they also reiterated that the Fed could be well positioned for a pause on rate hike decision later this year as they expected the global inflation risk would start to stabilize following the supply disruption issues solved. Recently, the bearish economic data had appeared to reduce the support for hawkish tone from Fed. Inflation rate expectations have been predicted lower, and tightening financial conditions are beginning to jeopardize the market demand in key sectors of the economy including housing and manufacturing industry. Investors currently would continue to scrutinize the lates updates with regards of further economic data to gauge the likelihood movement for US Dollar. As of writing, the Dollar Index depreciated by 0.21% to 102.05.

In the commodities market, the crude oil price surged 0.03% to $112.25 per barrel as of writing. The oil market received bullish momentum over the backdrop of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil inventories came in at -1.1019M, better than the market forecast at -0.737M. On the other hand, the gold price depreciated by 0.01% to $1853.75 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | -1.4% | -1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 218K | 213K | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | 2.1% | 2.0% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Apr) | -1.2% | -1.9% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2615, 1.2745

Support level: 1.2500, 1.2335

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0700, 1.0815

Support level: 1.0585, 1.0485

USDJPY, H4: USDJPY was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 127.30, 128.10

Support level: 126.10, 125.30

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7125, 0.7260

Support level: 0.6995, 0.6865

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 113.05, 115.10

Support level: 110.35, 106.65

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1868.70, 1878.95

Support level: 1849.90, 1836.90

250522 Afternoon Session Analysis

25 May 2022 Afternoon Session Analysis

US Dollar slumped amid economic recession concern.

The Dollar Index which traded against a basket of six major currencies extended its losses since yesterday over the backdrop of economic recession concern from the market. Despite the rate hike implementation that would likely combat inflation risk, the borrowing cost in the US region might increase significantly if Fed implies aggressive tightening monetary policy. The consumer spending would reduce as borrowing cost increased, which brought negative prospects toward economic progression in the US. Besides, the downbeat economic data had spurred further bearish momentum on the US Dollar. According to Census Bureau, US New Home Sales notched down from the previous reading of 709K to 591K, missing the market forecast of 750K. The lower than expected data indicated that the recession in the US housing market, dragged down the appeal of the US Dollar. As of writing, the Dollar Index edged up by 0.11% to 101.98.

In the commodities market, crude oil price appreciated by 1.10% to $110.97 per barrel as of writing, boosted by tight supplies and the prospect of rising demand from the upcoming start of the US summer driving season. On the other hand, gold price depreciated by 0.36% to $1858.69 per troy ounces as of writing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Press Conference

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q1) | 0.2% | 0.2% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Apr) | 1.2% | 0.6% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | 1.383M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 127.20, 128.00

Support level: 126.25, 125.10

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1878.85, 1901.20

Support level: 1855.05, 1833.15

250522 Morning Session Analysis

25 May 2022 Morning Session Analysis

Pound slumped amid growing recession fears.

The Pound Sterling slumped following the economic data indicated that the UK private sector growth unexpectedly slumped in May, insinuating further fears upon recession while dragging down the appeal for Pound Sterling. On the economic data front, the Markit Economics reported that the UK Composite Purchasing Managers’ Index (PMI) and UK Manufacturing Purchasing Managers Index (PMI) came in at 51.8 and 54.6, both fared worse than market expectation at 56.5 and 54.9 respectively. Besides, the UK Services Purchasing Managers Index (PMI) notched down significantly from the previous reading at 58.9 to 51.8, missing the market forecast at 56.9, according to the Chartered Institute of Purchasing & Supply and the NTC economics. As most of the crucial manufacturing data slowed much more than expectation, which spurring further recession worries while diminishing the probability for the Bank of England to increase interest rate. As of writing, GBP/USD depreciated by 0.02% to 1.2540.

In the commodities market, the crude oil price retreated 0.02% to $110.60 per barrel as of writing over the backdrop of bearish inventory data. According to American Petroleum Institute (API), the US Crude inventories increased by 567,000 barrels for last week, missing the market forecast at dropping 690,000 barrels. On the other hand, the gold price surged by 0.01% to $1866.85 per troy ounces as of writing amid the rising recession fears continue to drive up the market demand on the safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Press Conference

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q1) | 0.2% | 0.2% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Apr) | 1.2% | 0.6% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | 1.383M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2615, 1.2745

Support level: 1.2500, 1.2335

EURUSD, H4: EURUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0815, 1.0925

Support level: 1.0700, 1.0585

USDJPY, H1: USDJPY was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 127.15, 128.10

Support level: 126.10, 125.30

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7125, 0.7260

Support level: 0.6995, 0.6865

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 113.05, 115.10

Support level: 110.35, 106.65

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1878.95, 1900.10

Support level: 1863.25, 1848.55

240522 Afternoon Session Analysis

24 May 2022 Afternoon Session Analysis

Atlanta Fed unleashed dovish talk, US Dollar beaten down.

The Dollar Index which traded against a basket of six major currencies slumped to its recent low from yesterday over the dovish speech was unleashed from Atlanta Federal Reserve. According to Reuters, Atlanta Fed President Raphael Bostic appeared a speech on Monday, which claimed that it “might make sense” for the Federal Reserve to pause further interest rate hikes following expected half-point rate increases over the next two months as the central bank assesses the impact on inflation and the economy. As Fed might pause rate hike implementation, it would likely to reduce the risk-off return of investors, dragged down the appeal for the US Dollar. Besides, US President Joe Biden considering to reduce tariffs on China, which claimed on Monday. The reducing tariffs on China would likely to boost up the international transaction between US and China, dialed up the market optimism toward economic progression in US, and prompting investors to shift their capitals toward risk-appetite assets such as stocks. As of writing, the Dollar Index edged up by 0.22% to 102.32.

In commodities market, crude oil price depreciated by 0.73% to $109.48 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish over the soaring demand on oil due to the easing lockdown in China. On the other hand, gold price appreciated by 0.04% to $1848.74 per troy ounces as of writing following the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (May) | 54.6 | 54.0 | – |

| 16:30 | GBP – Composite PMI | 58.2 | – | – |

| 16:30 | GBP – Manufacturing PMI | 55.8 | – | – |

| 16:30 | GBP – Services PMI | 58.9 | – | – |

| 22:00 | USD – New Home Sales (Apr) | 763K | 750K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0500

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1883.35, 1915.65

Support level: 1851.70, 1830.15

240522 Morning Session Analysis

24 May 2022 Morning Session Analysis

Euro surged following ECB signaled rate hike.

The Euro received significant bullish momentum yesterday following the European Central Bank unleashed their hawkish tone toward the economic momentum in Europe region. According to CNBC, the ECB President Christine Lagarde claimed that the central bank is likely to raise its deposit interest rate from negative territory by the end of September and could raise further if it sees the inflation unable to stabilize at 2.0%. Currently, the ECB’s deposit rate is -0.5%, meaning the commercial banks are charged for depositing cash at the central bank. Besides, the Euro extend its gains over the backdrop of upbeat economic data. According to Ifo Institute for Economic Research, Germany Ifo Business Climate Index notched up from the previous reading at 91.9 to 93.0, exceeding the market forecast at 91.4. As of writing, EUR/USD appreciated by 0.01% to 1.0690.

In the commodities market, the crude oil price slumped 1.05% to $109.40 per barrel as of writing. The oil market edged lower amid investors concern that rising recession risk in future would likely to drag down the market demand on this black-commodity. On the other hand, the gold price surged 0.03% to $1854.10 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (May) | 54.6 | 54.0 | – |

| 16:30 | GBP – Composite PMI | 58.2 | – | – |

| 16:30 | GBP – Manufacturing PMI | 55.8 | – | – |

| 16:30 | GBP – Services PMI | 58.9 | – | – |

| 22:00 | USD – New Home Sales (Apr) | 763K | 750K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correcgtion.

Resistance level: 1.2615, 1.2745

Support level: 1.2500, 1.2335

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0700, 1.0855

Support level: 1.0585, 1.0485

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7125, 0.7260

Support level: 0.6995, 0.6865

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend it losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum to extend its losses toward support level.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 110.35, 113.05

Support level: 106.65, 104.05

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1863.25, 1878.95

Support level: 1848.55, 1829.40

230522 Afternoon Session Analysis

23 May 2022 Afternoon Session Analysis

Pound rose following upbeat economic data was unleashed.

The Pound extend its gains on Monday amid the backdrop of positive retail sales data, which dialed up the market optimism toward Pound Sterling. According to Office for National Statistics, UK Retail Sales MoM notched up from the previous reading of -1.2% to 1.4%, exceeding the market forecast of -0.2%. The higher than expected reading indicated that the consumer spending in UK region was increased, which brought positive prospects toward economic progression in UK. Besides, the rising inflation risk would increase the odds of Bank of England (BoE) to implement tightening monetary policy. According to Bloomberg, Britain’s inflationary shock is likely to be worse than feared, BoE Chief Economist Huw Pill said as he warned price pressures were “substantial” and further interest-rate increases will be needed. The implementation of rate hike would likely to increase the risk-free return of investors, spurring further bullish momentum on the Pound. For now, investors would continue to scrutinize the latest updates with regards of the rate hike decision from BoE in order to gauge the likelihood movement of GBPUSD. As of writing, GBPUSD edged up by 0.40% to 1.2537.

In commodities market, crude oil price appreciated by 0.37% to $110.69 per barrel as of writing over the easing lockdown in China had led to the soaring demand on crude oil. On the other hand, gold price appreciated by 0.48% to $1850.60 per troy ounces as of writing following the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German ifo Business Climate Index (May) | 91.8 | 91.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 103.15, 103.75

Support level: 102.50, 101.75

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0605, 1.0685

Support level: 1.0500, 1.0415

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9795

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1851.70, 1883.35

Support level: 1830.15, 1798.35