230522 Morning Session Analysis

23 May 2022 Morning Session Analysis

US Dollar slumped amid the growing recession fears upon the United States.

The Dollar Index which traded against a basket of six major currencies retreated from its higher-level last week amid the growing concerns upon the stagflation risk in future. Recently, bankers and economists warned that the US economy would be heading toward recession in the next year as the mounting worries that the rising borrowing costs for consumers and business as well as the spiking inflation risk continue to weigh down the economic prospect in the United States. Meanwhile, the inflation rate, which remains near 40-year highs has become a challenge for the economy and the global central bank. Nonetheless, investors would continue to scrutinize the latest updates with regards of the Federal Reserve’s meeting minutes to receive further signal about the monetary policy decision from Fed. As of writing, the Dollar Index depreciated by 0.23% to 102.90.

In the commodities market, the crude oil price slumped 0.72% to $110.05 per barrel as of writing amid concerns upon the global economic recession continue to drag down the appeal of this black-commodity. On the other hand, the gold price appreciated by 0.03% to $1847.30 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German ifo Business Climate Index (May) | 91.8 | 91.4 | – |

Technical Analysis

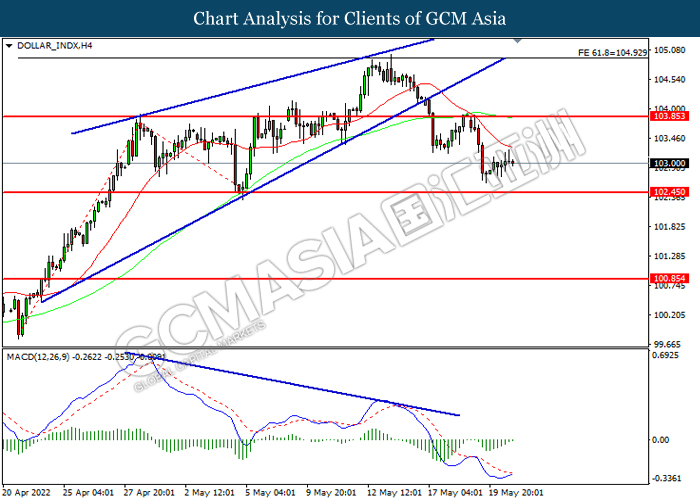

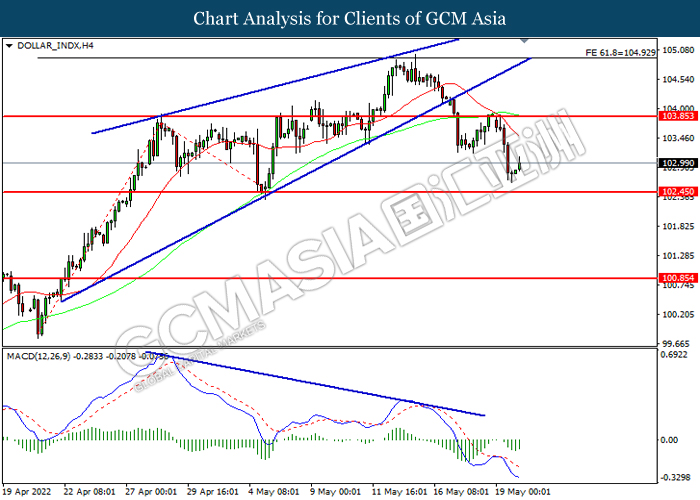

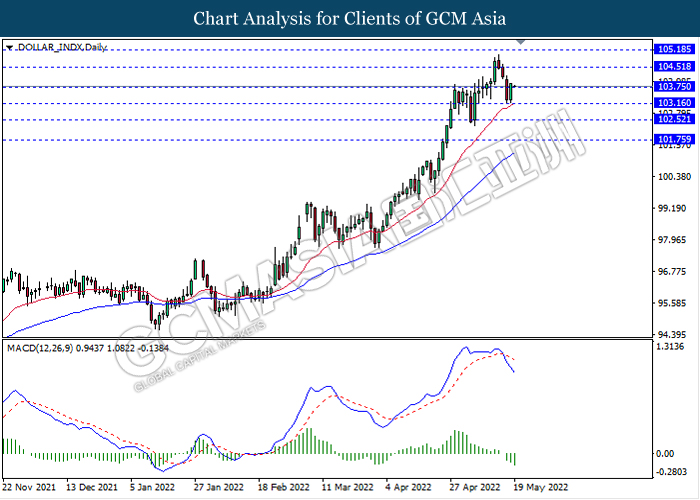

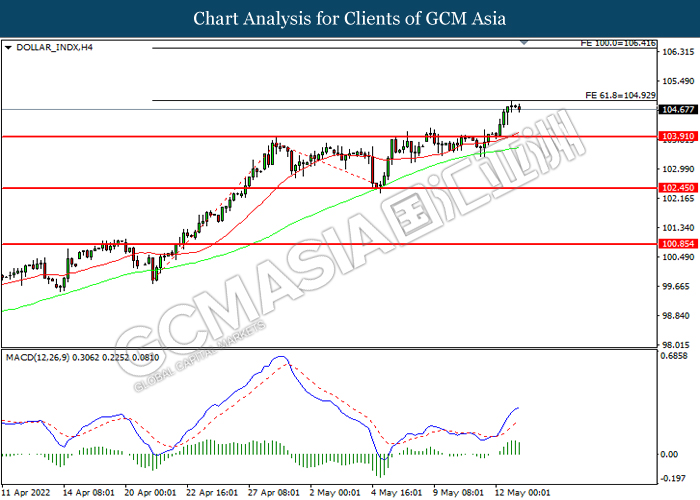

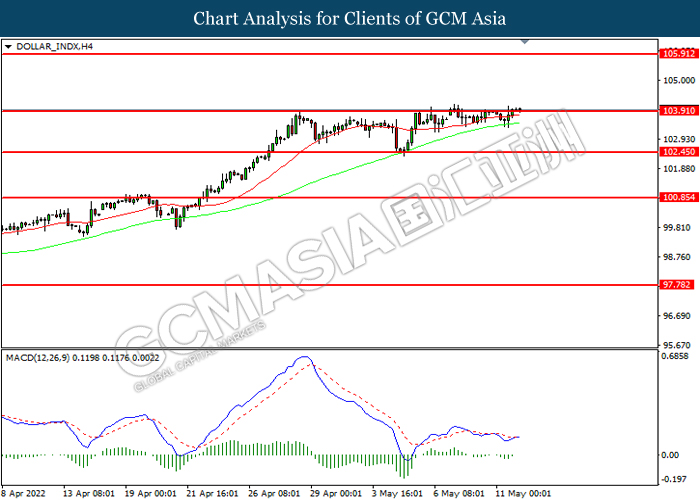

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 103.85, 104.95

Support level: 102.45, 100.85

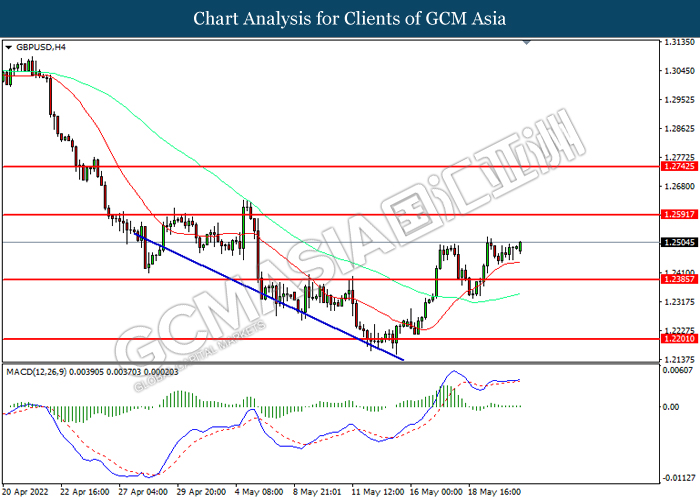

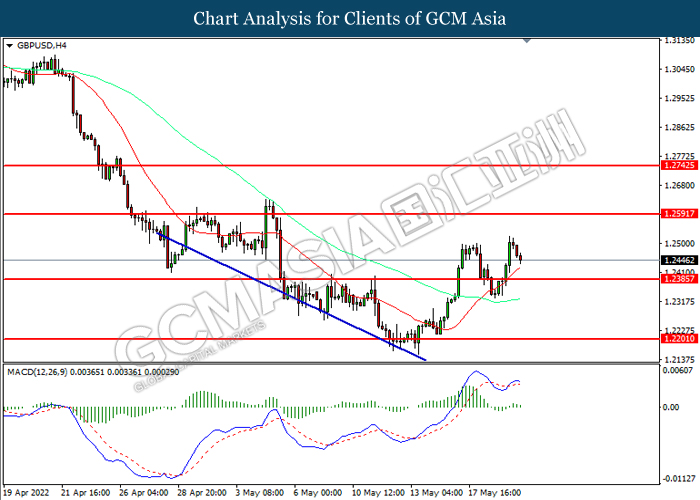

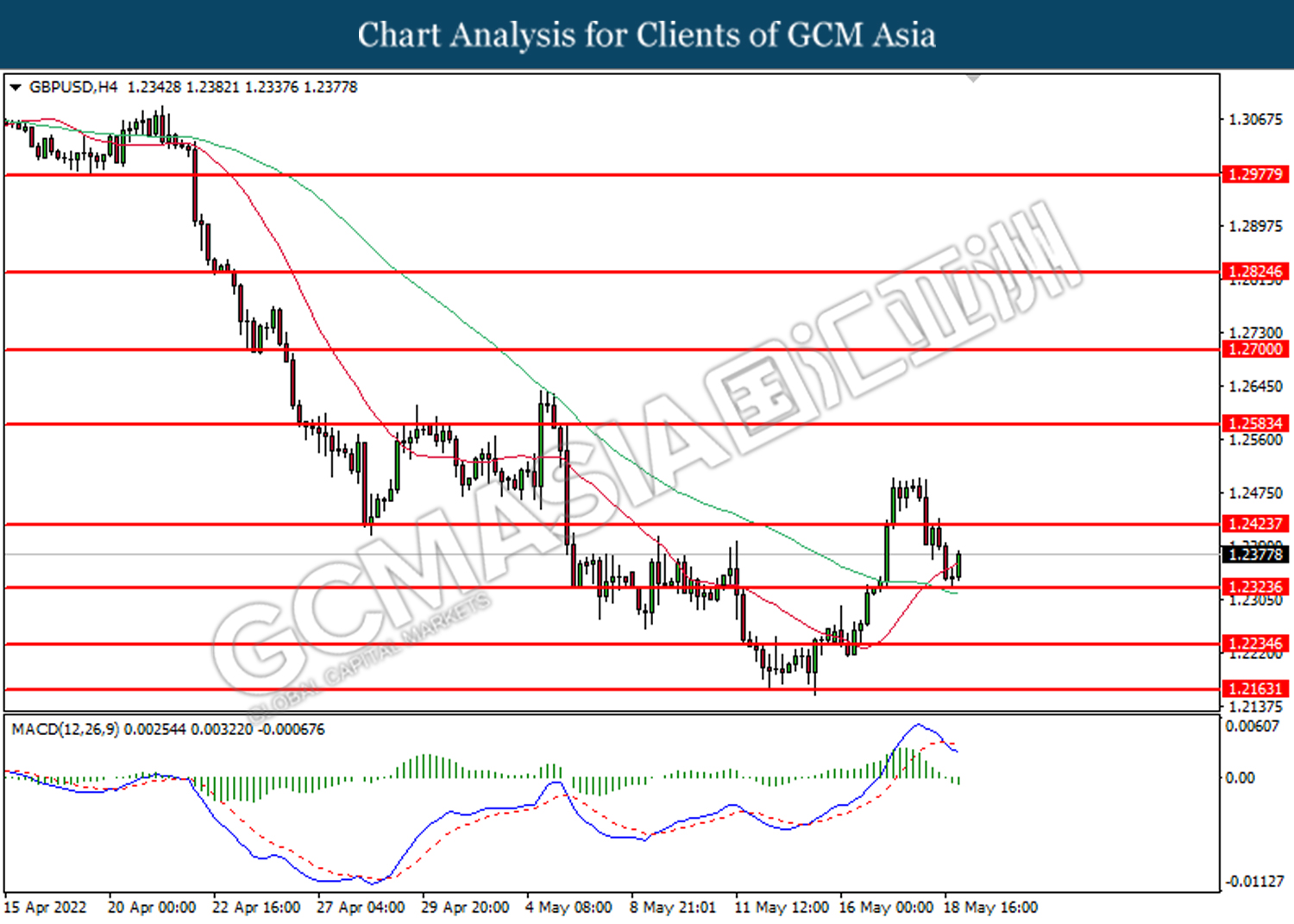

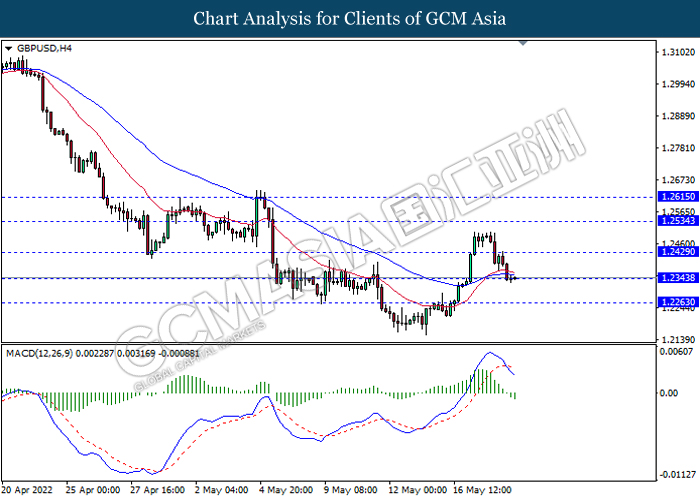

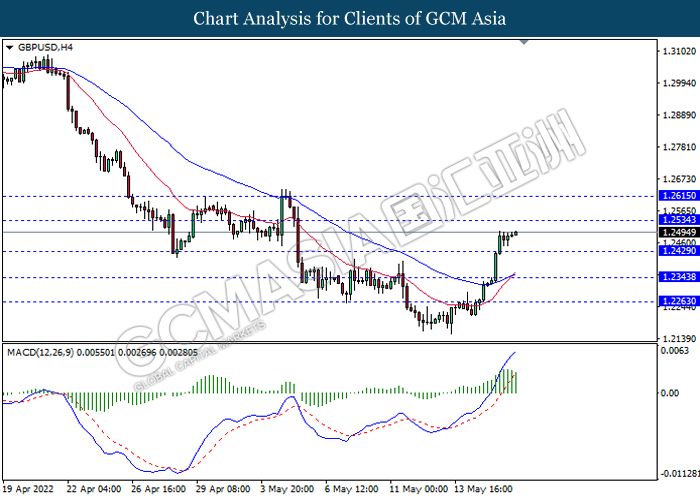

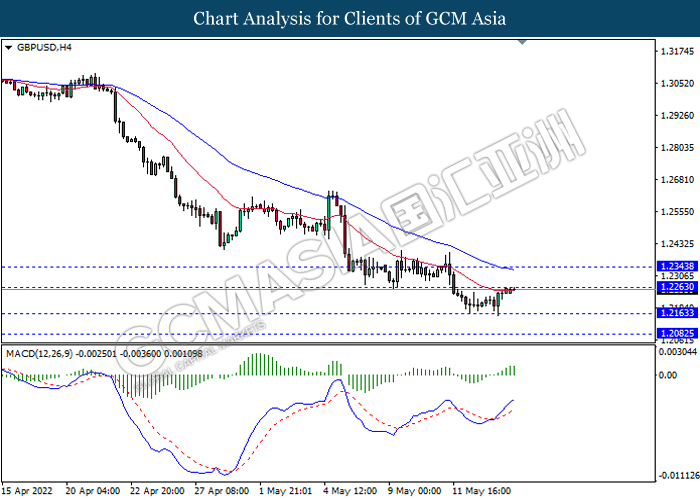

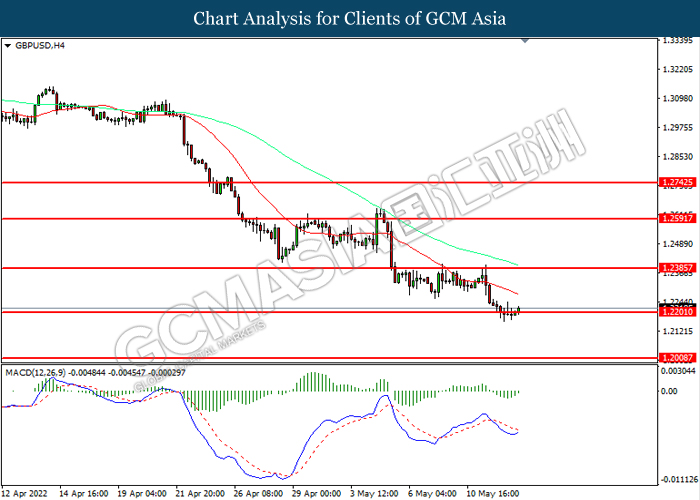

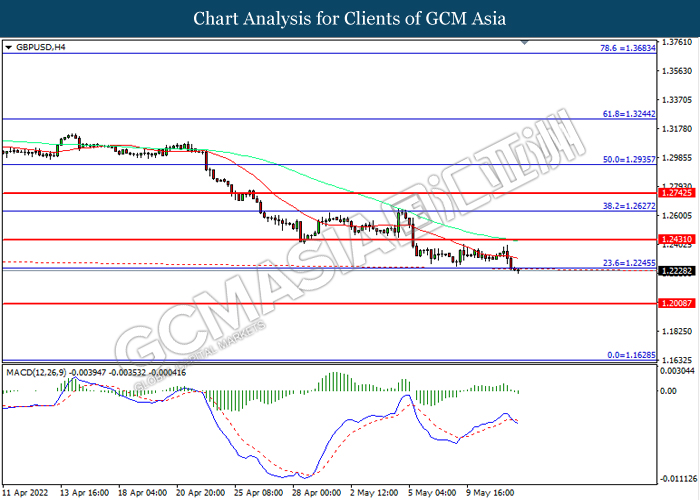

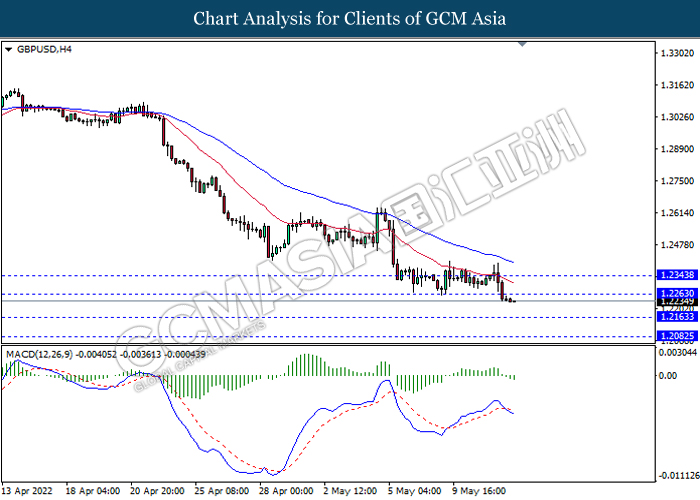

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2590, 1.2745

Support level: 1.2385, 1.2200

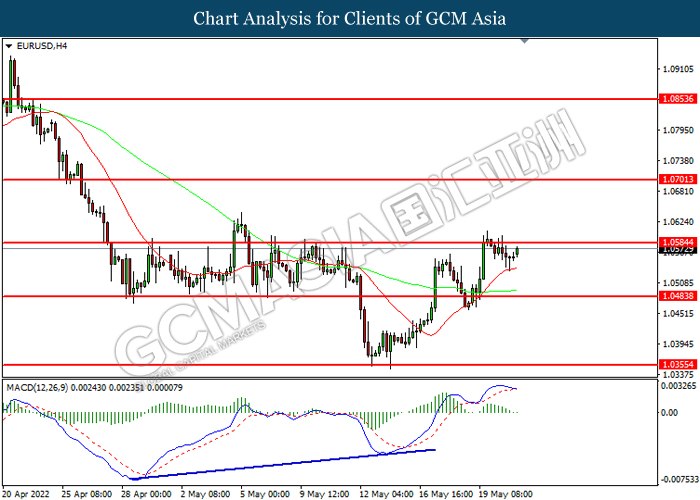

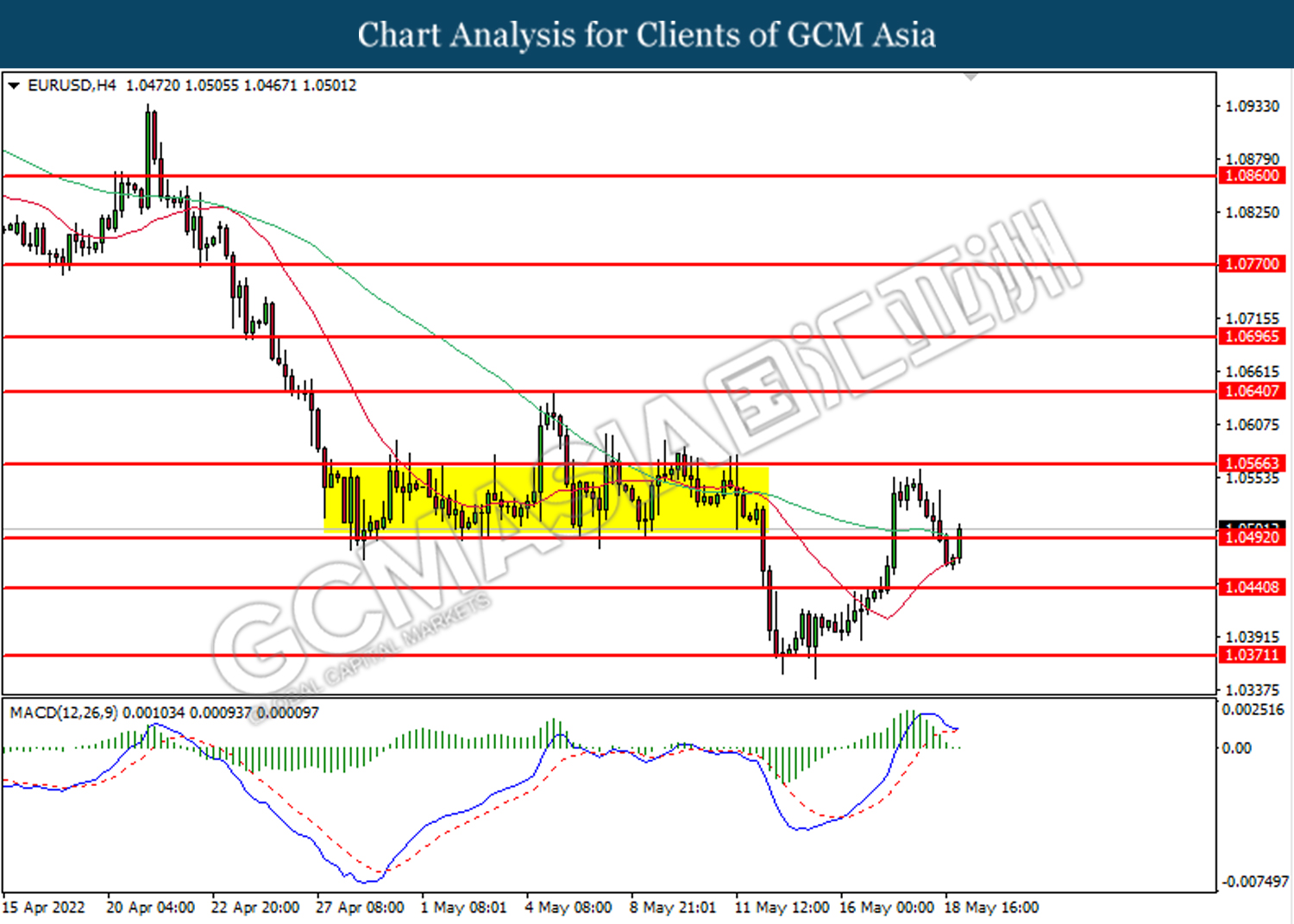

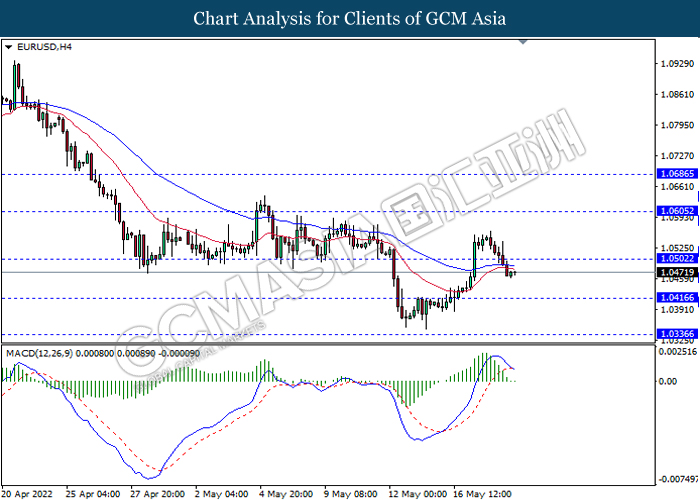

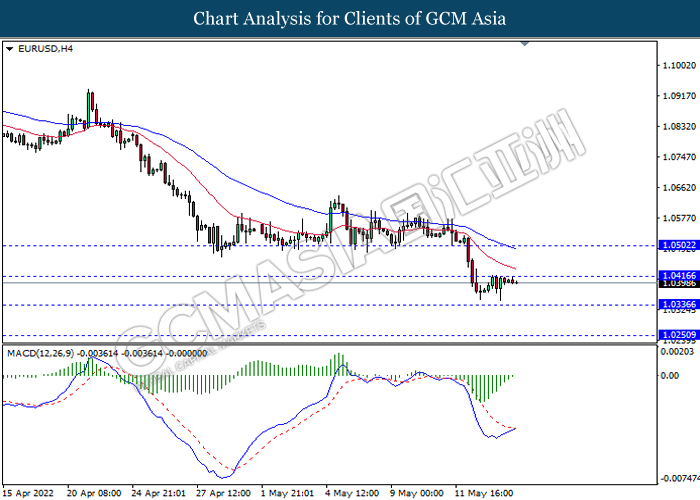

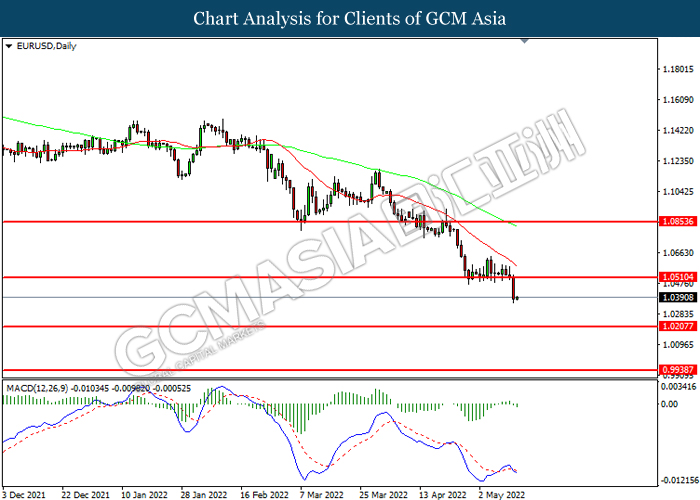

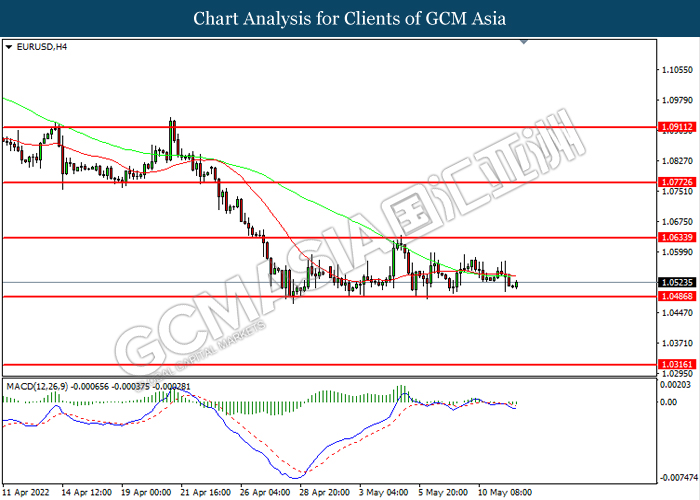

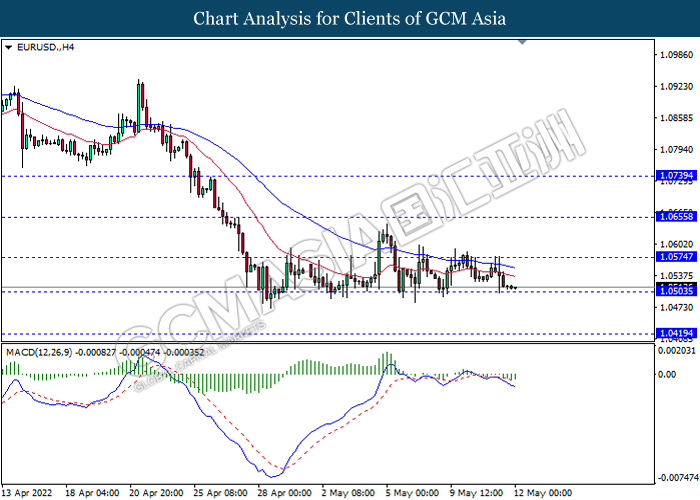

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0585, 1.0700

Support level: 1.0485, 1.0355

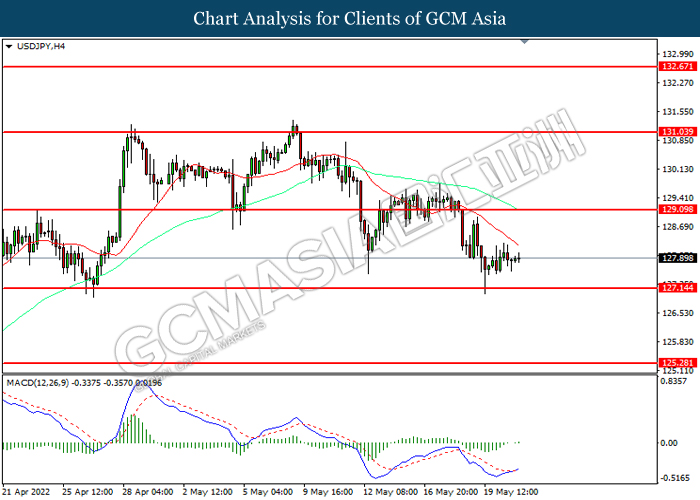

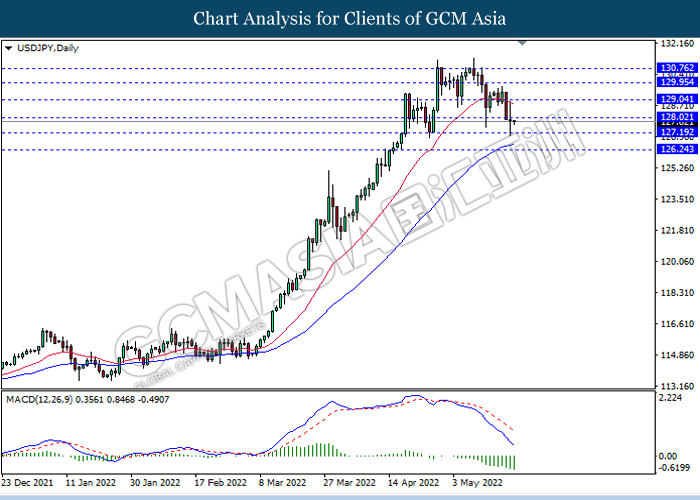

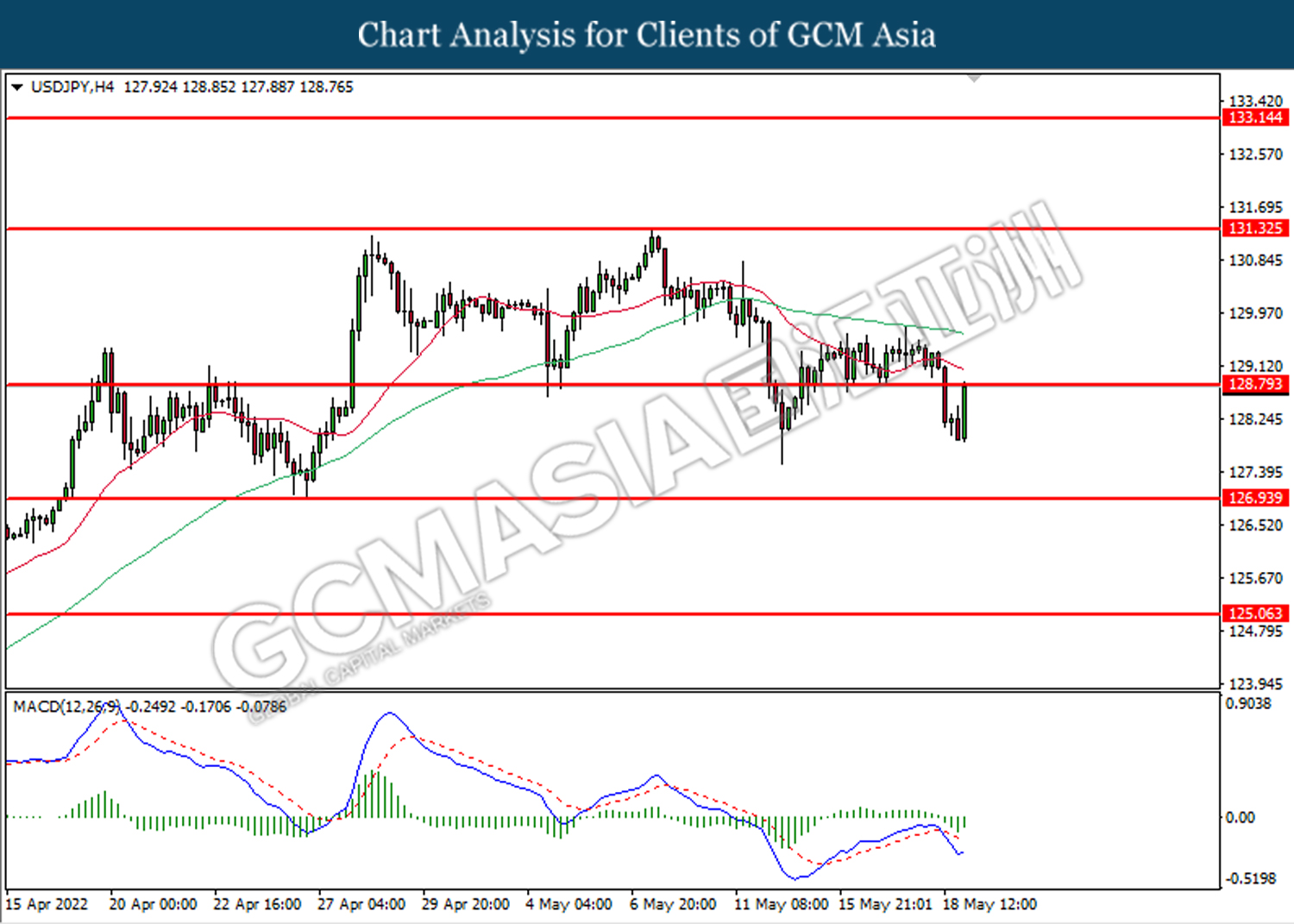

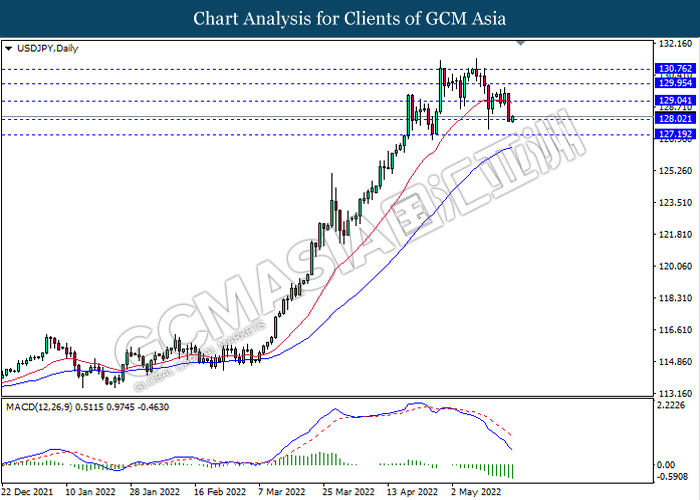

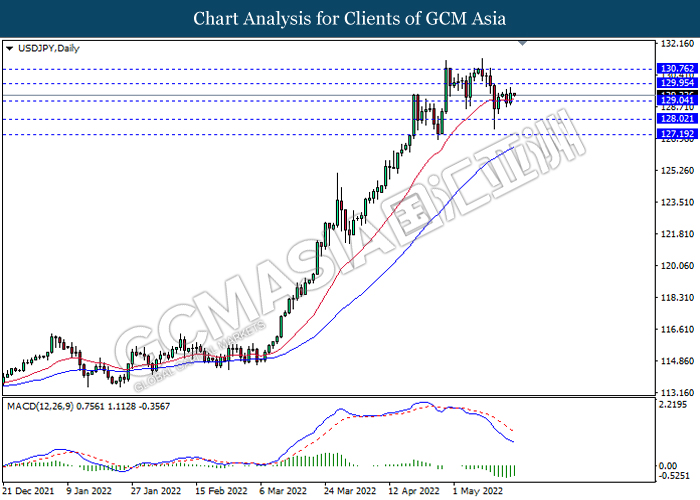

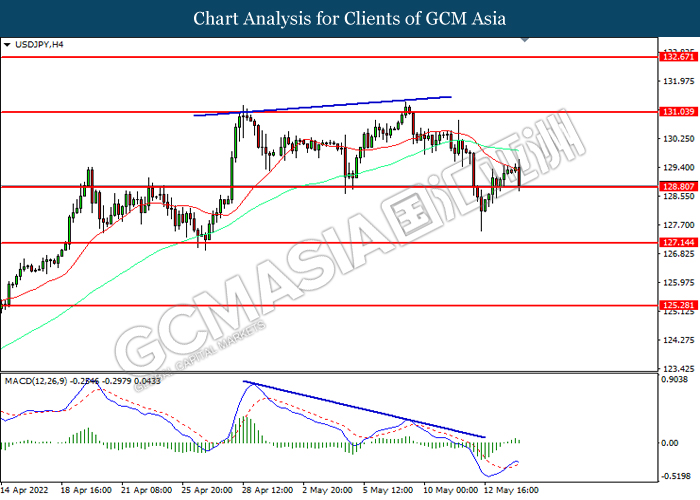

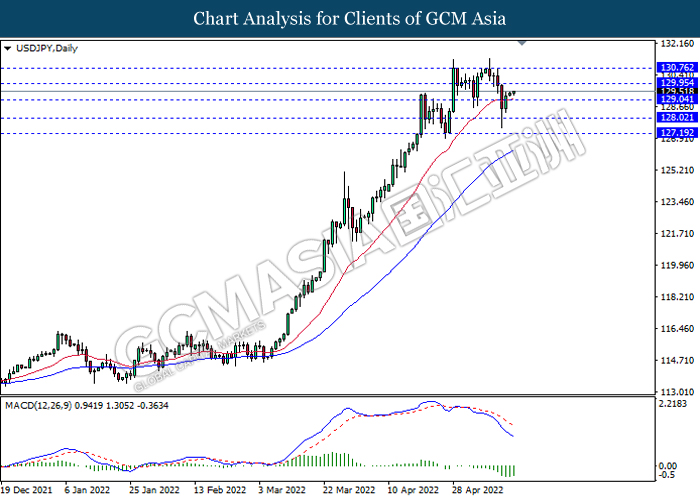

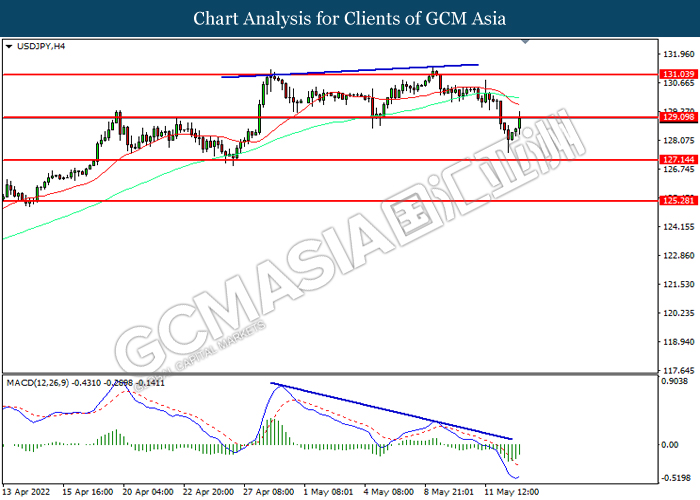

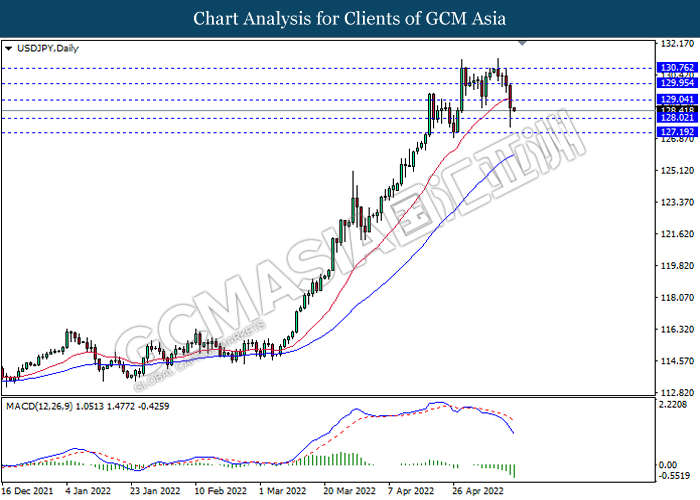

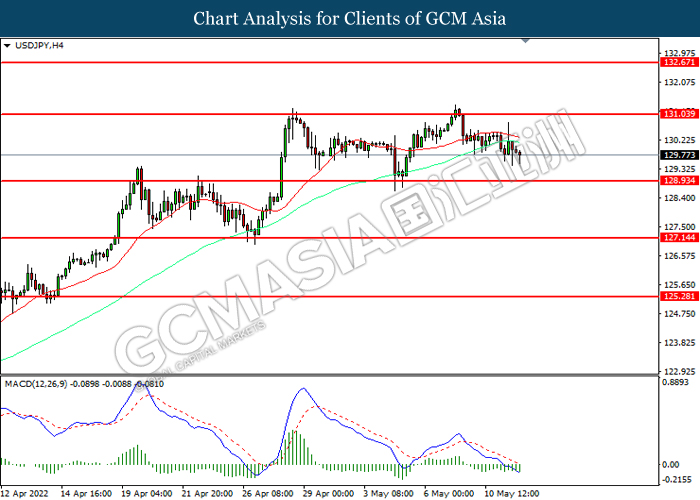

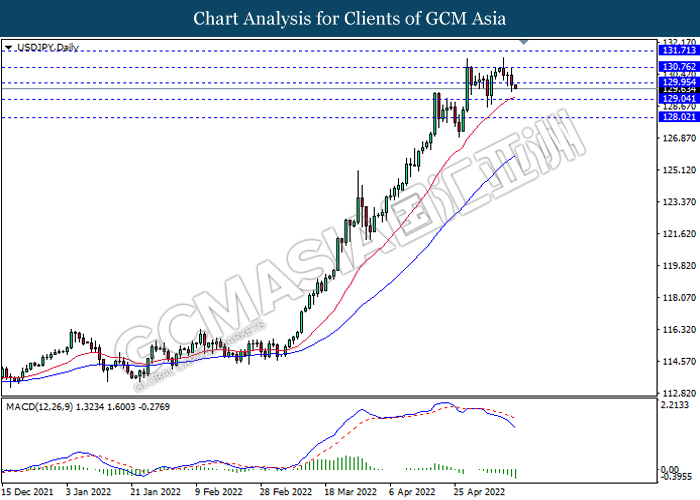

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

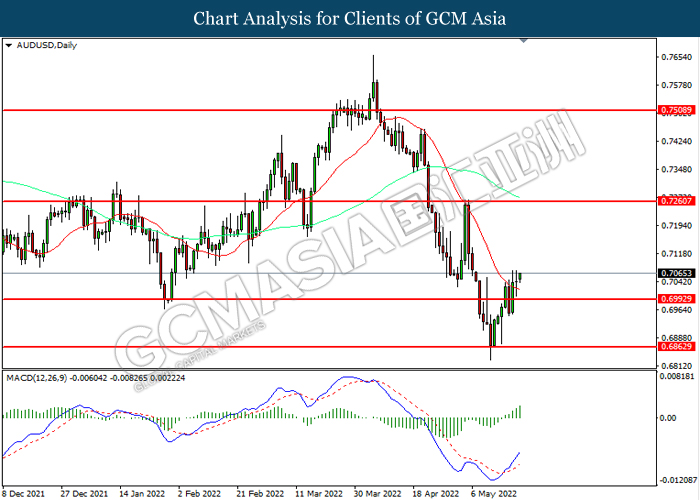

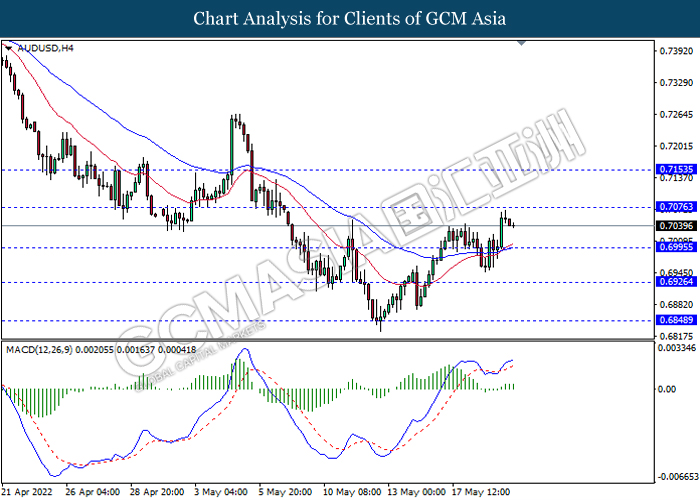

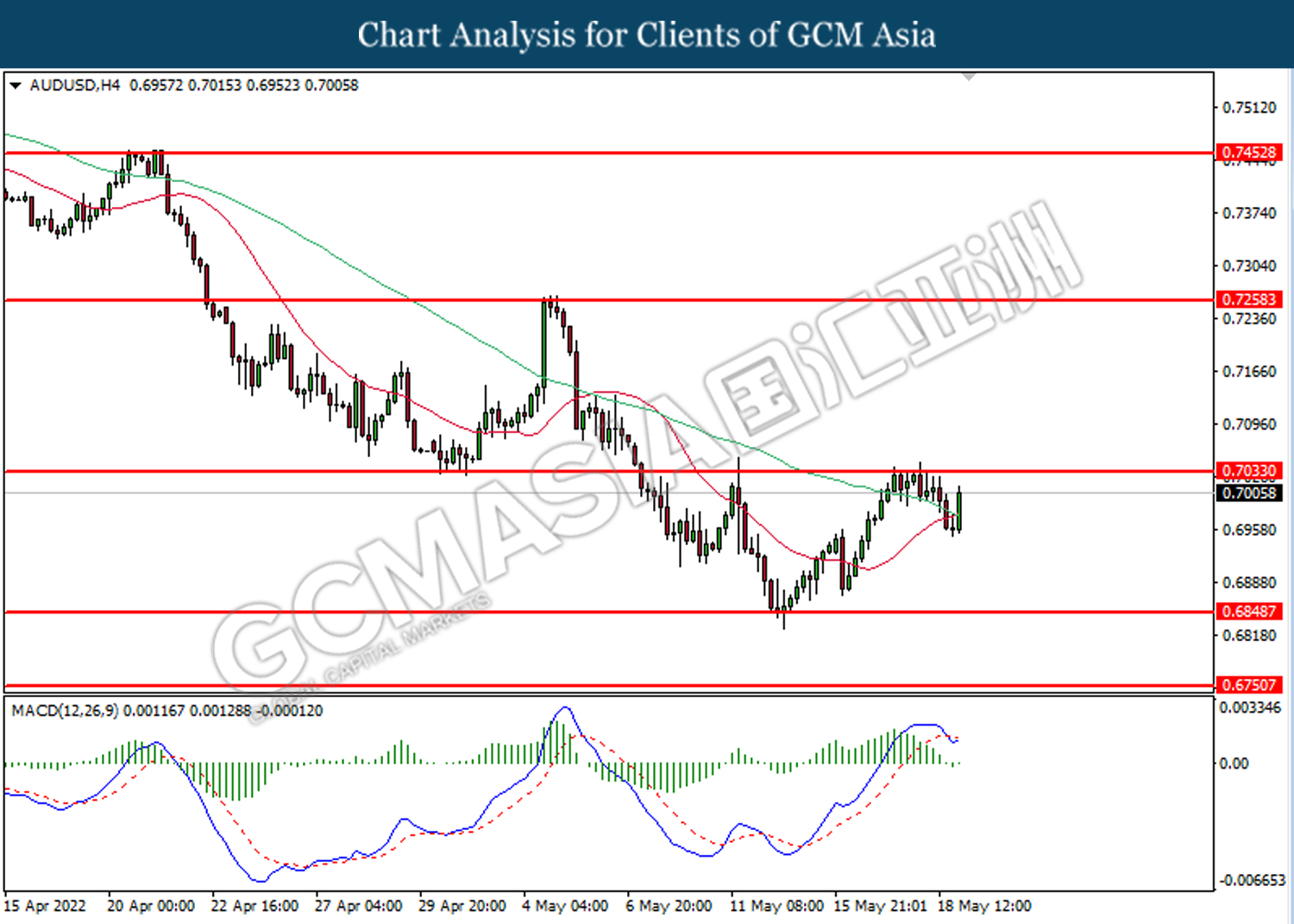

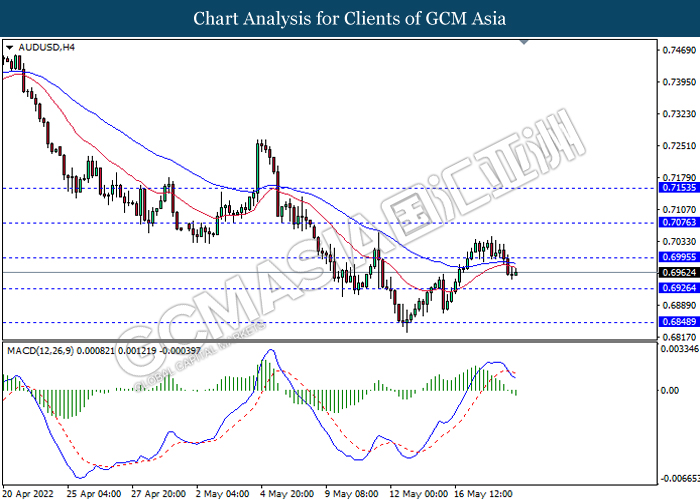

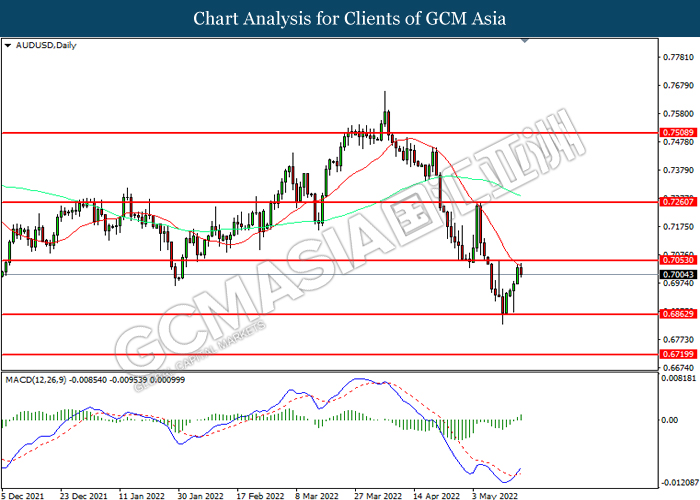

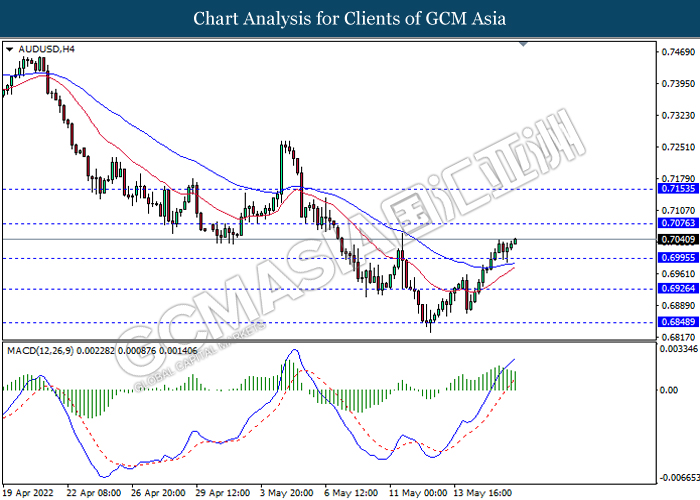

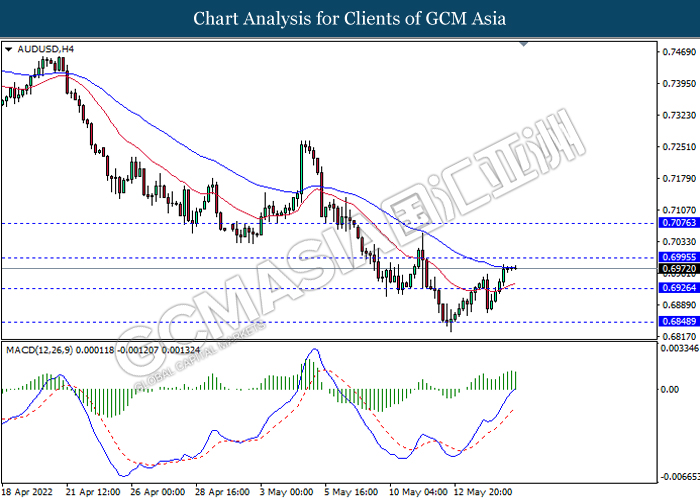

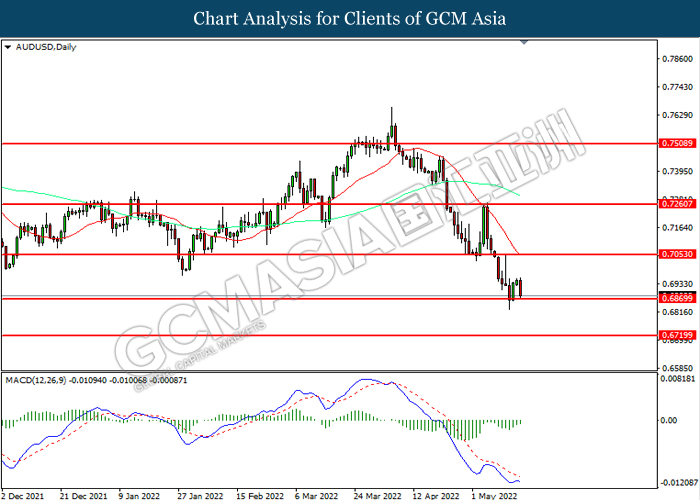

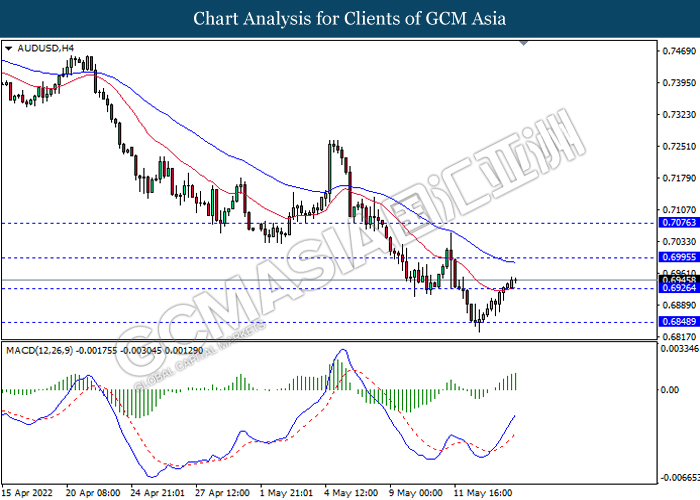

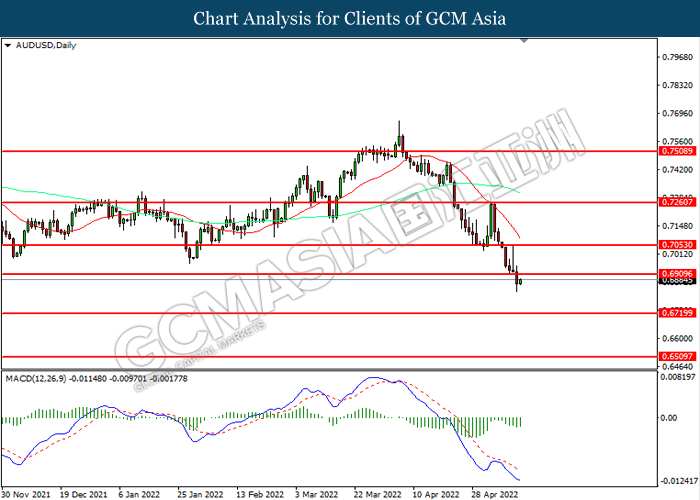

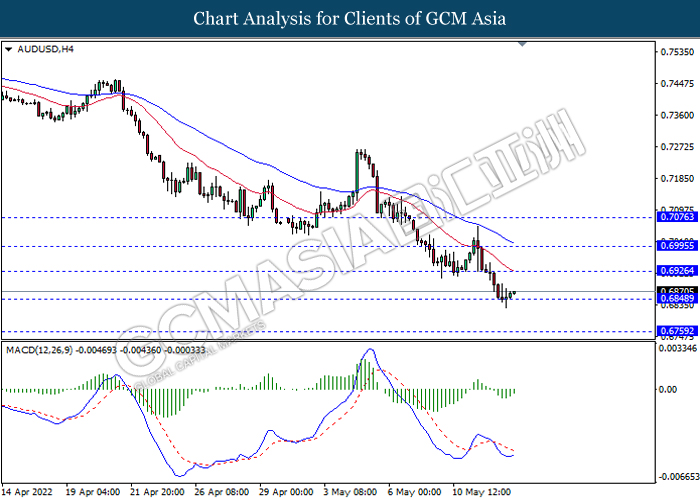

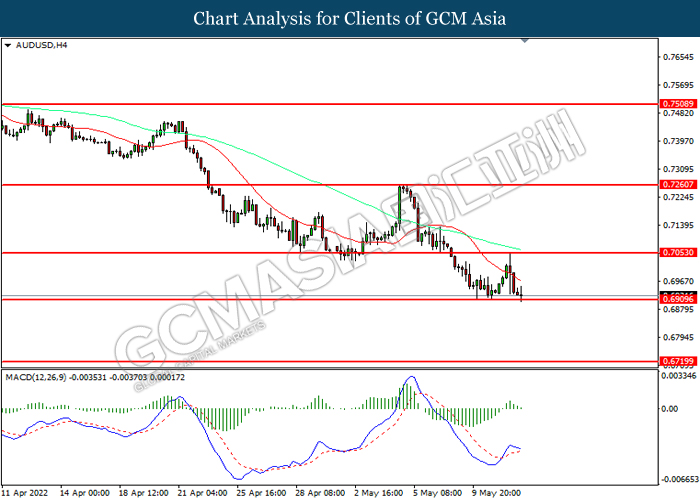

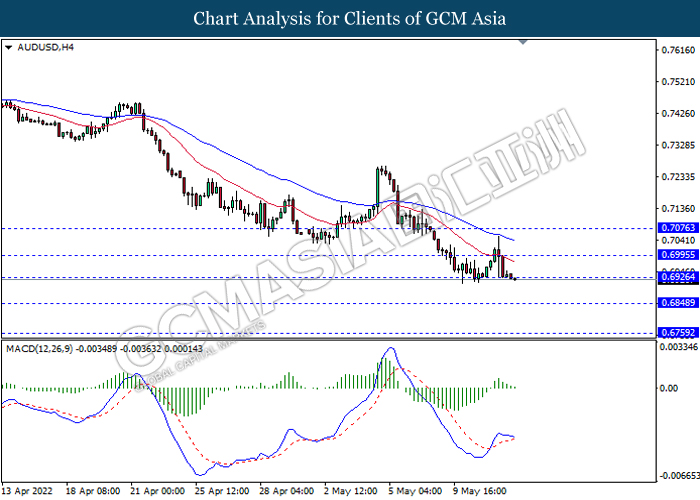

AUDUSD, Daily: AUDUSD was traded higher following prior breakout resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.7260, 0.7510

Support level: 0.6995, 0.6865

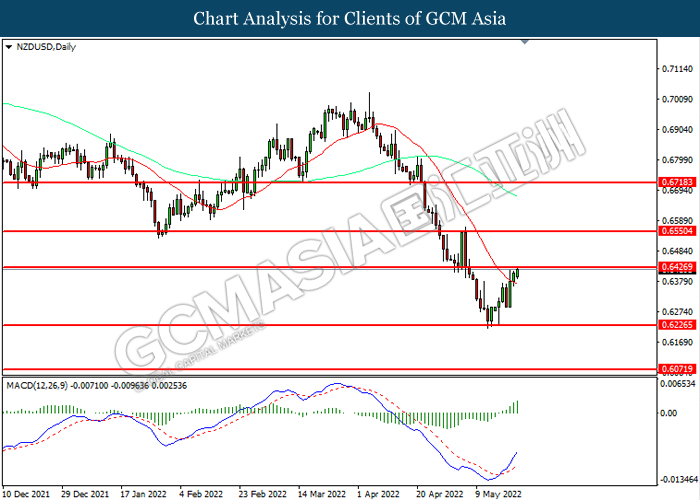

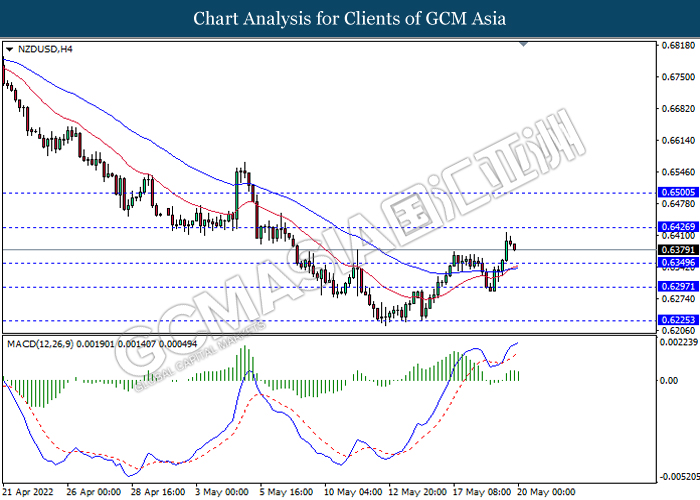

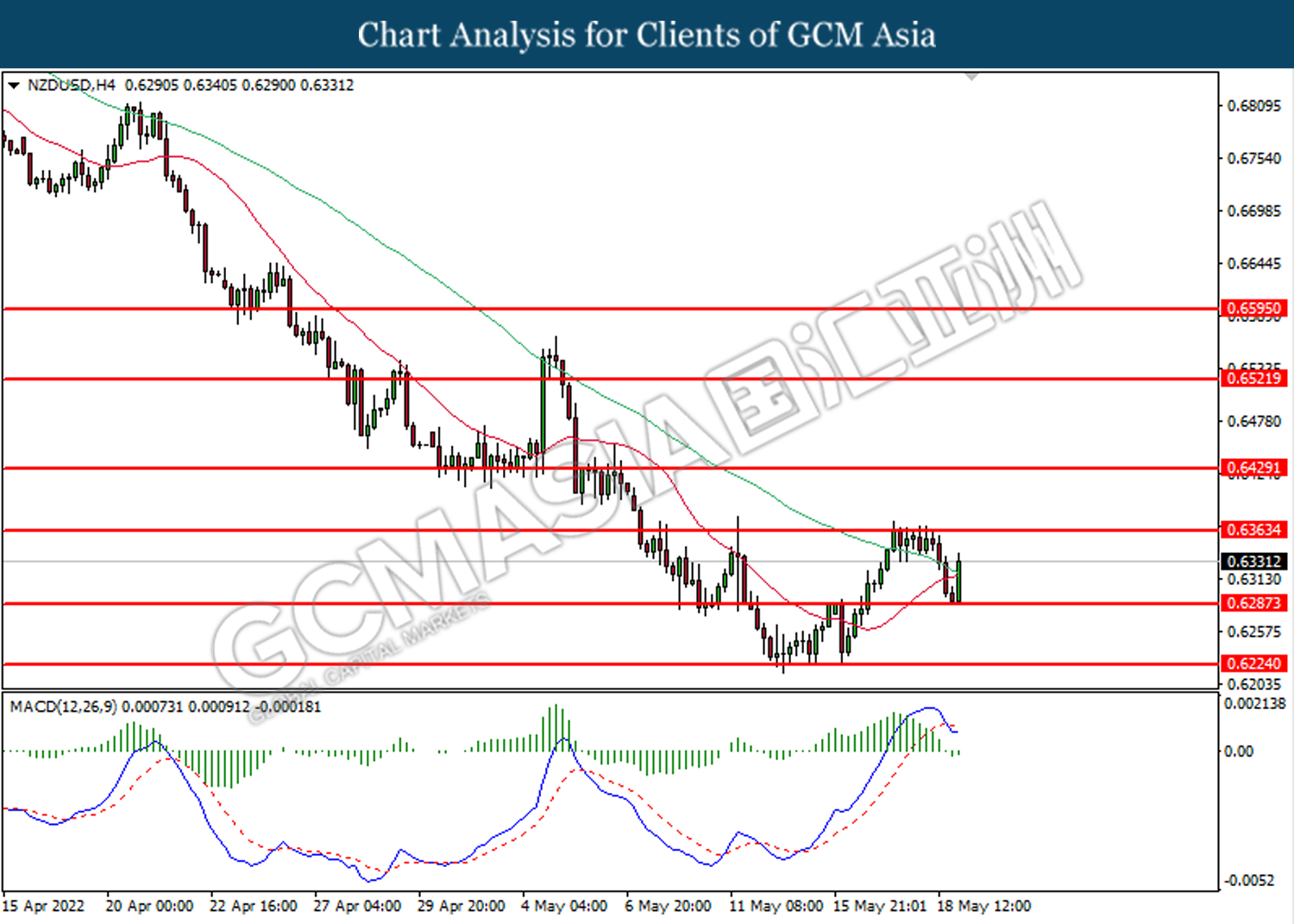

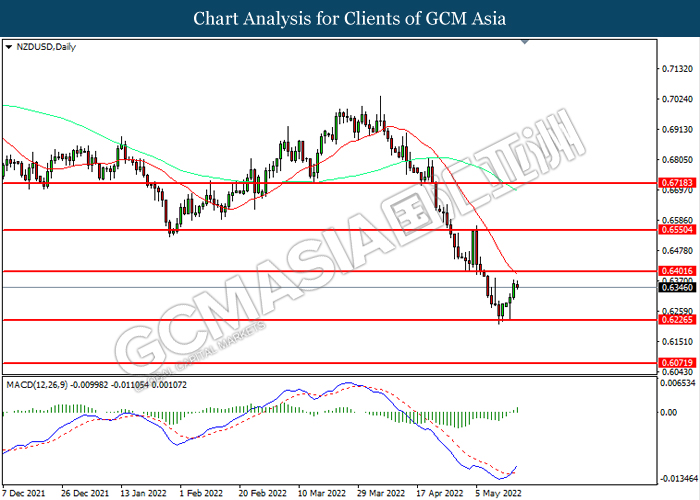

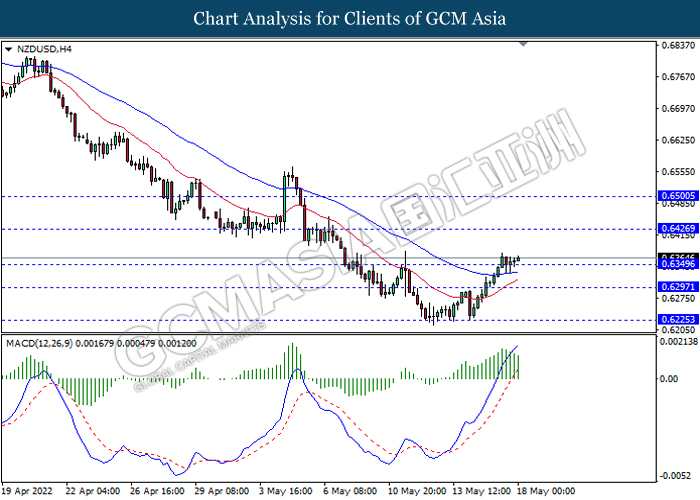

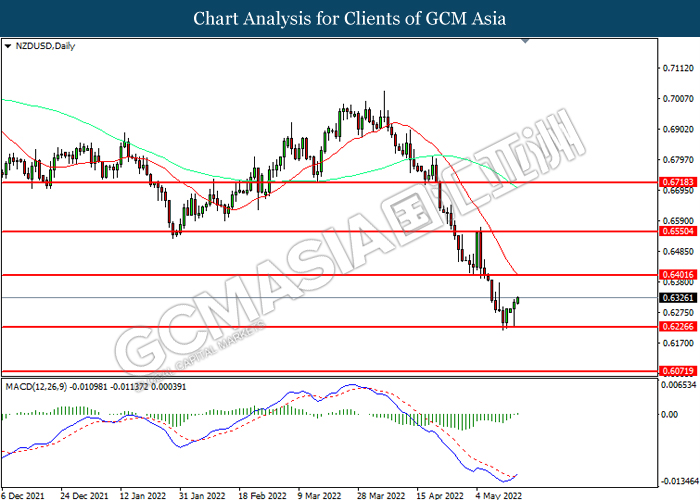

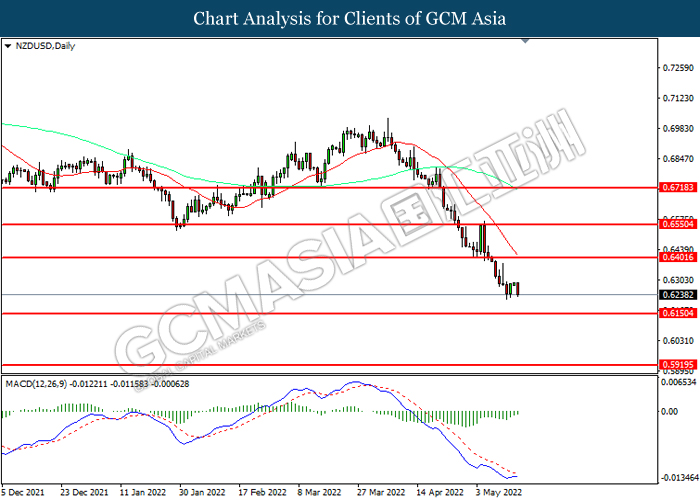

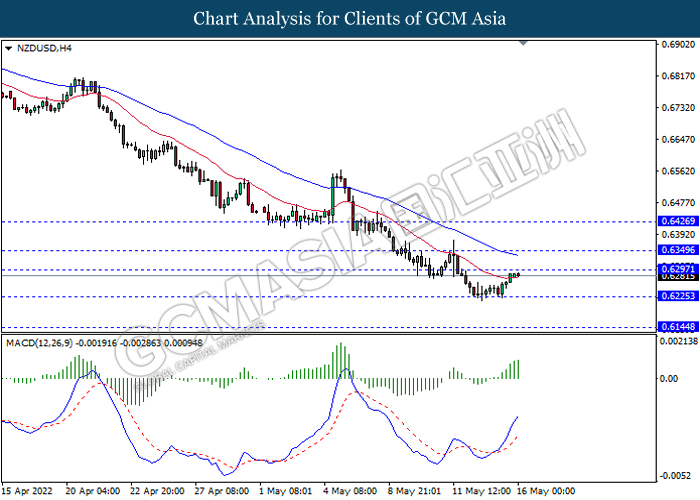

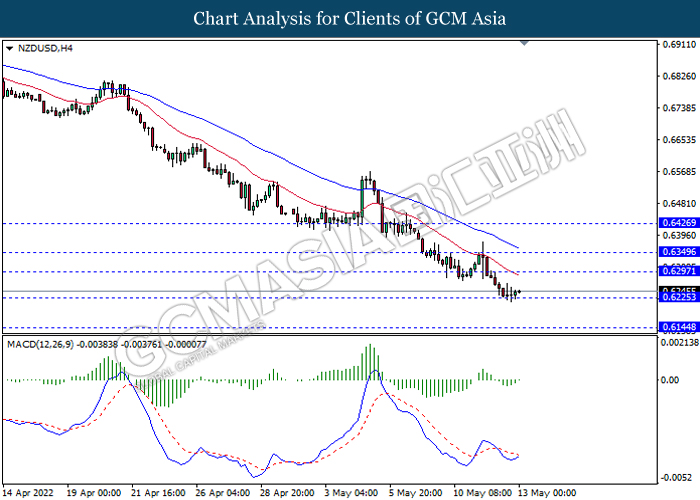

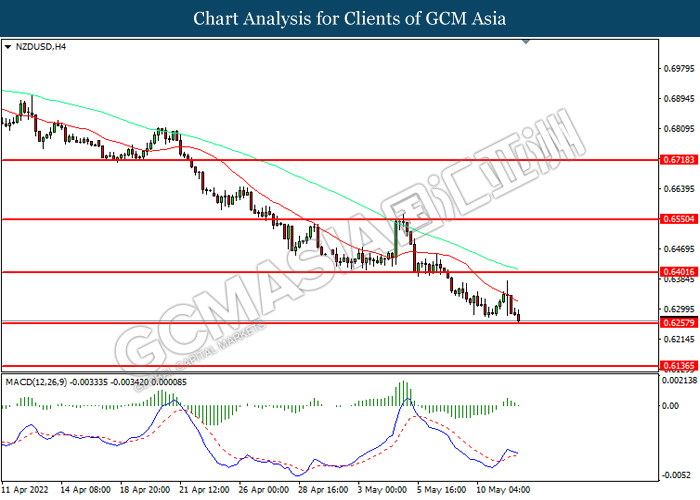

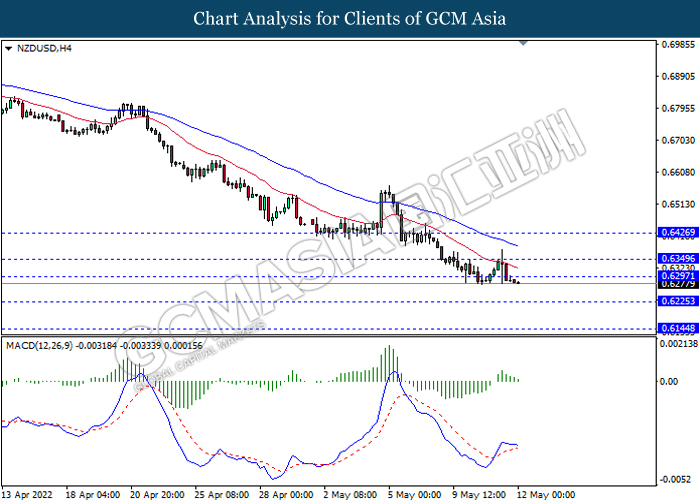

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.6425, 0.6550

Support level: 0.6225, 0.6070

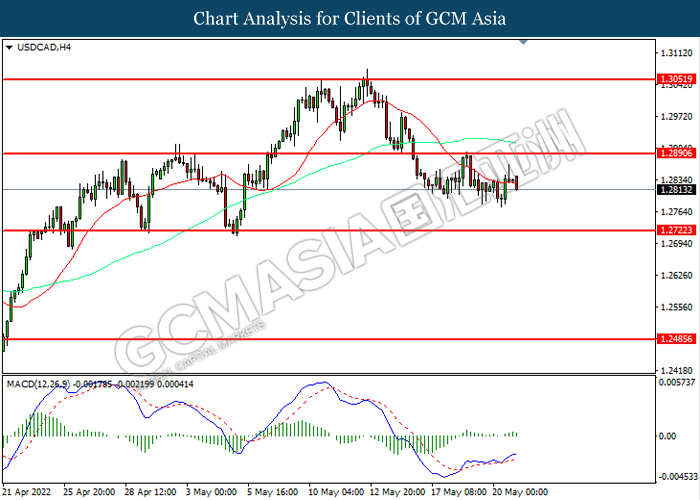

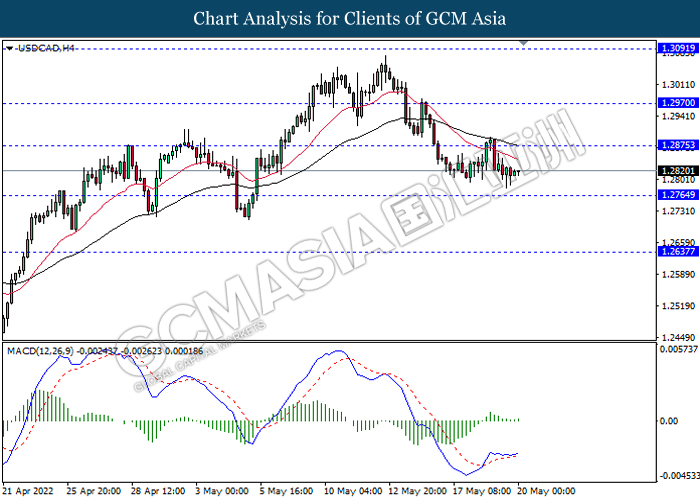

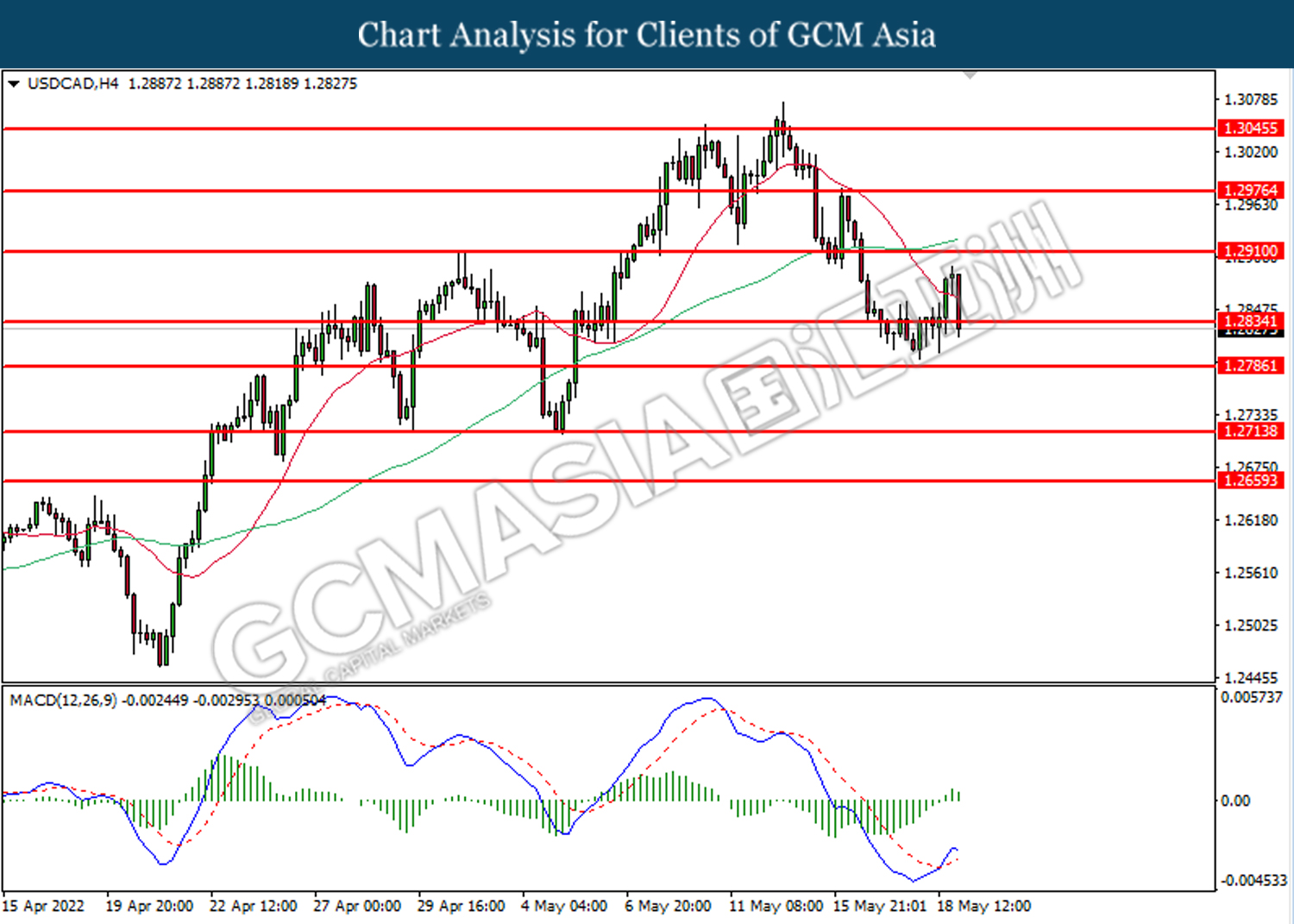

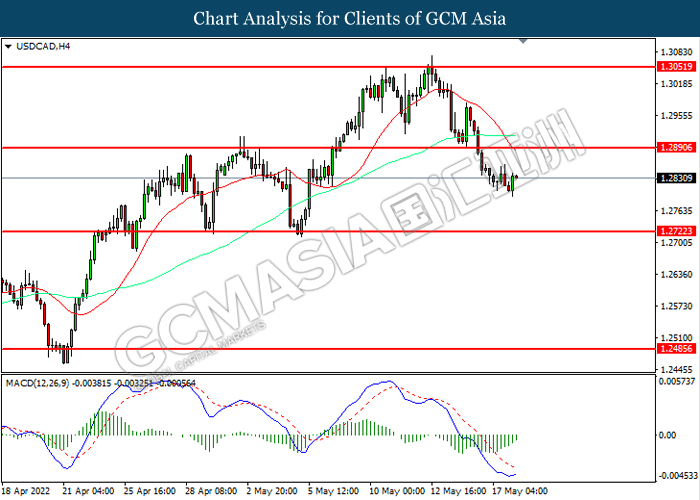

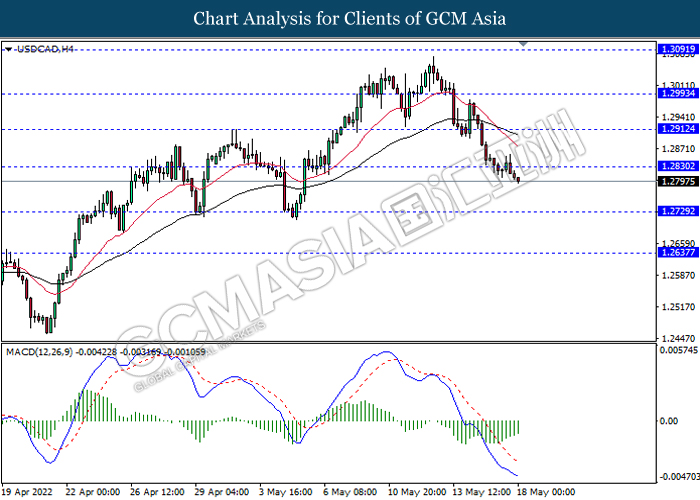

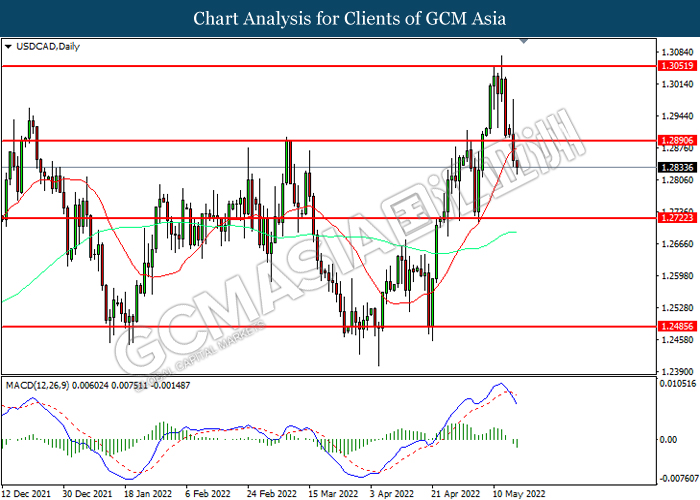

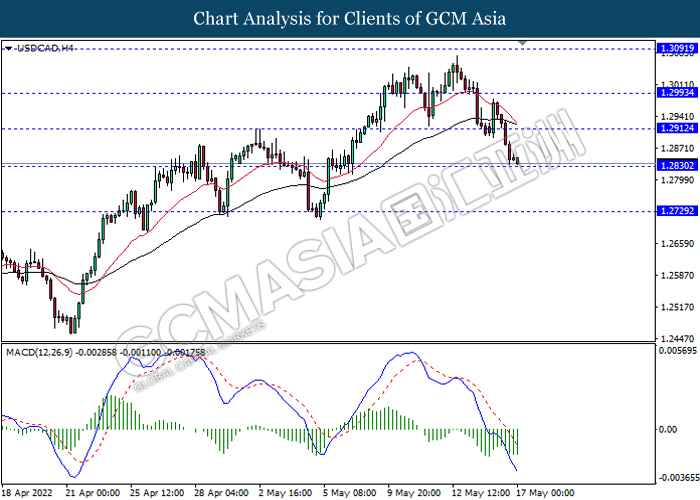

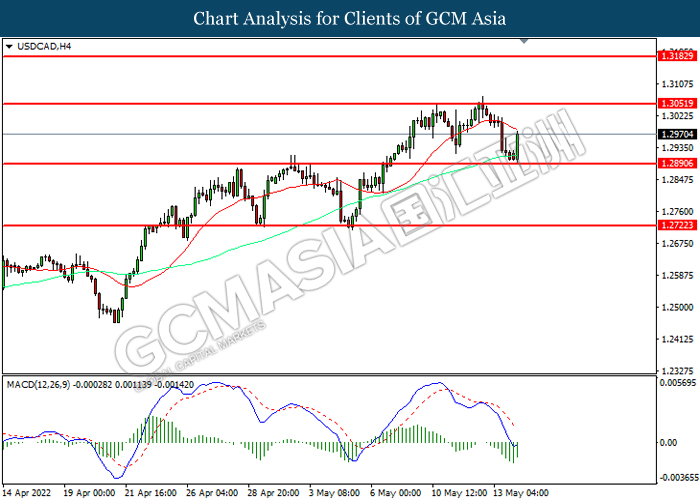

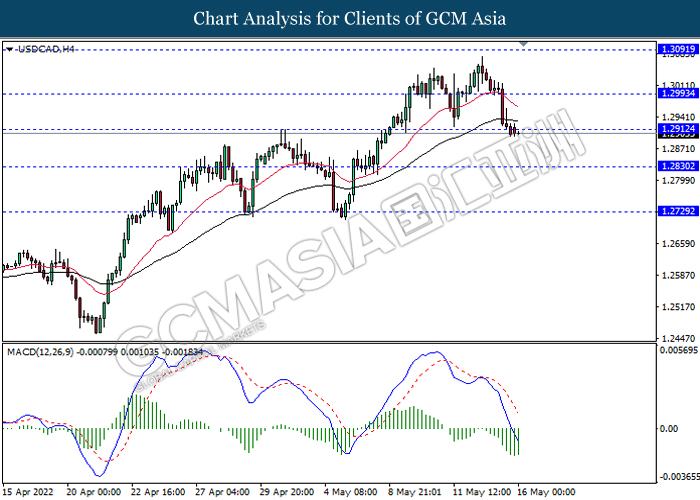

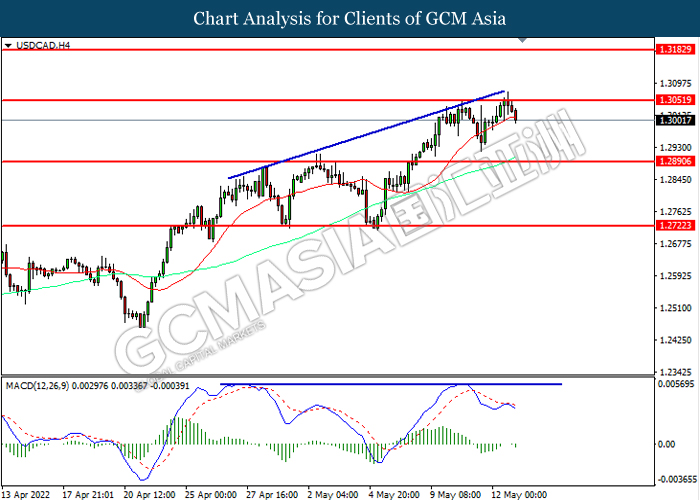

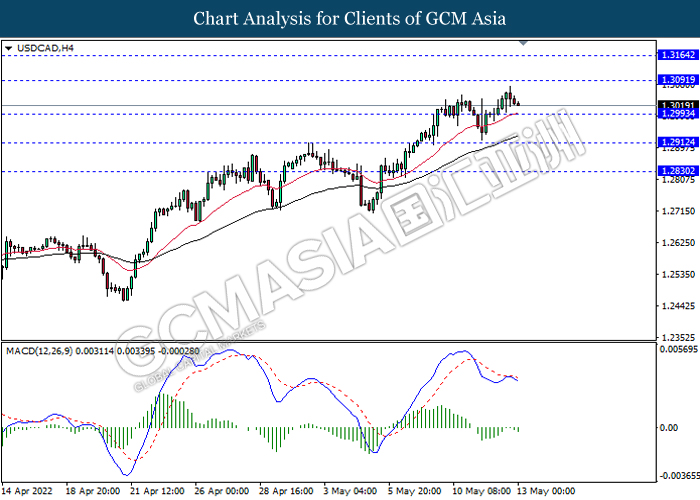

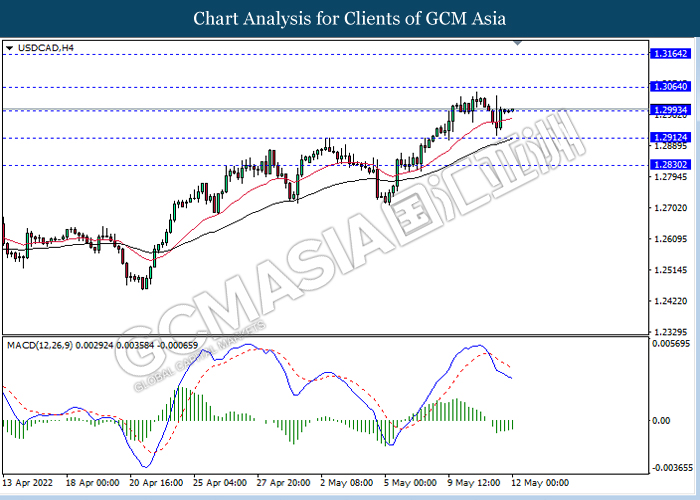

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend it losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

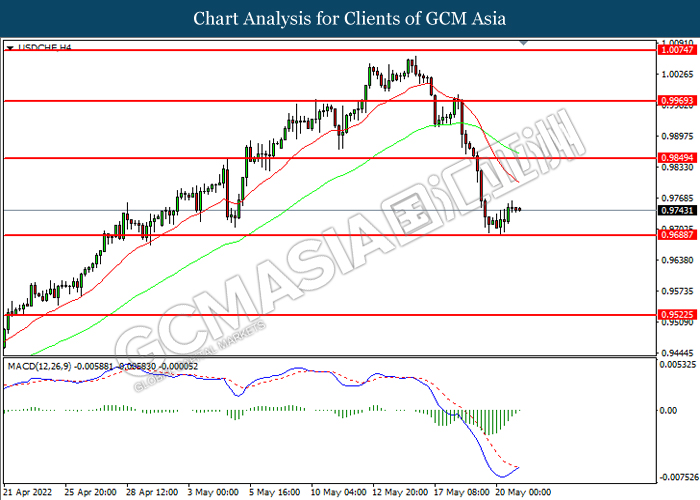

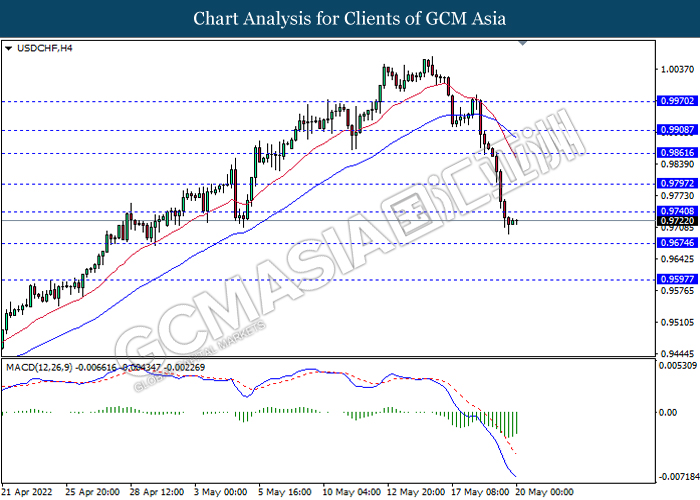

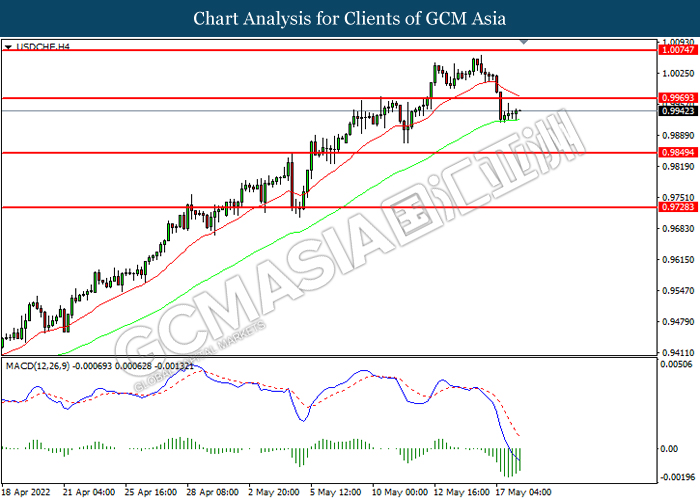

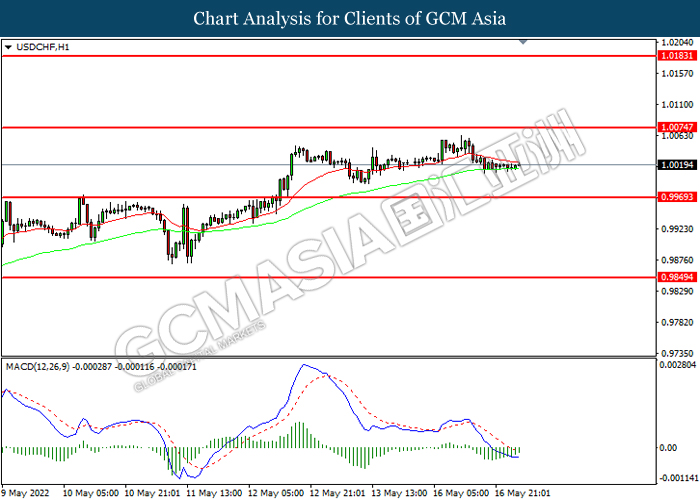

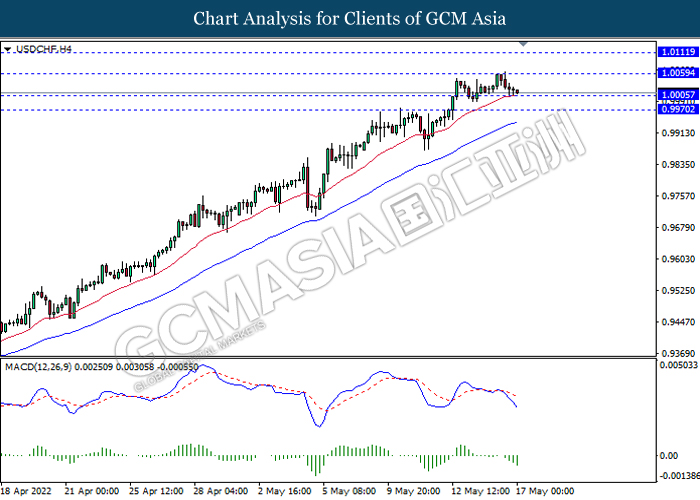

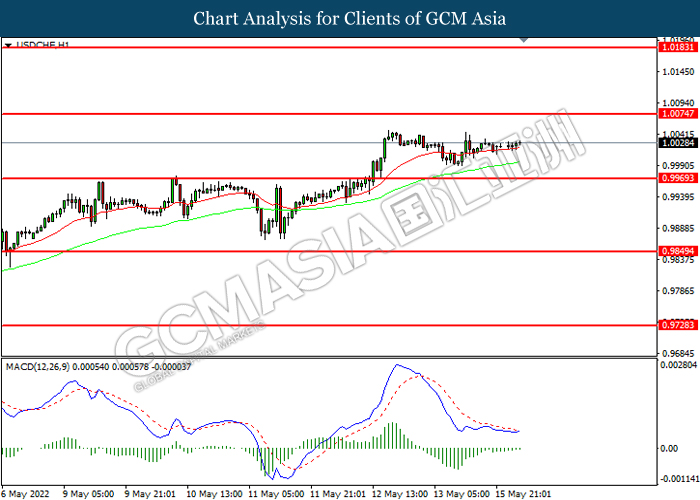

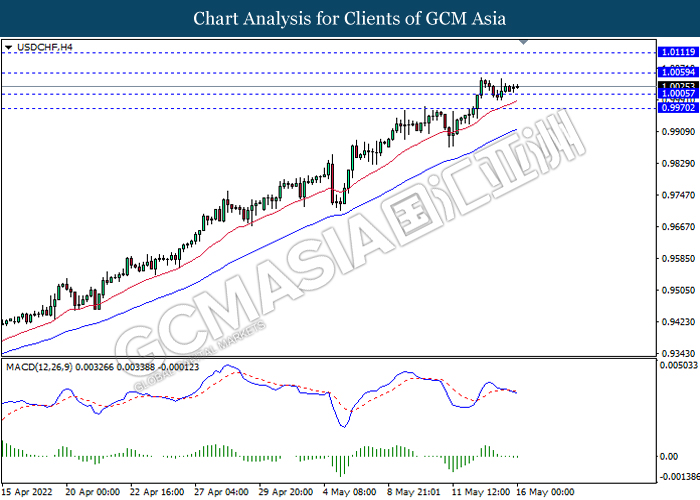

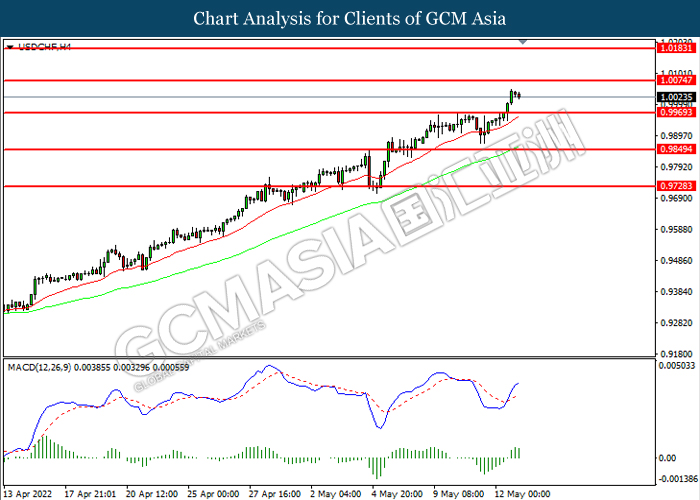

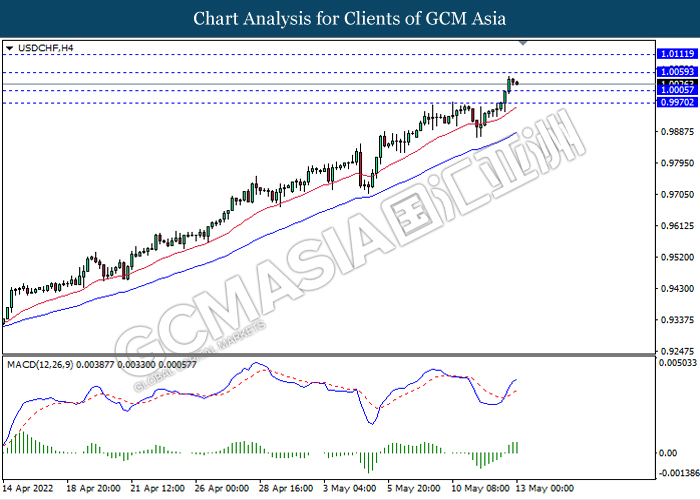

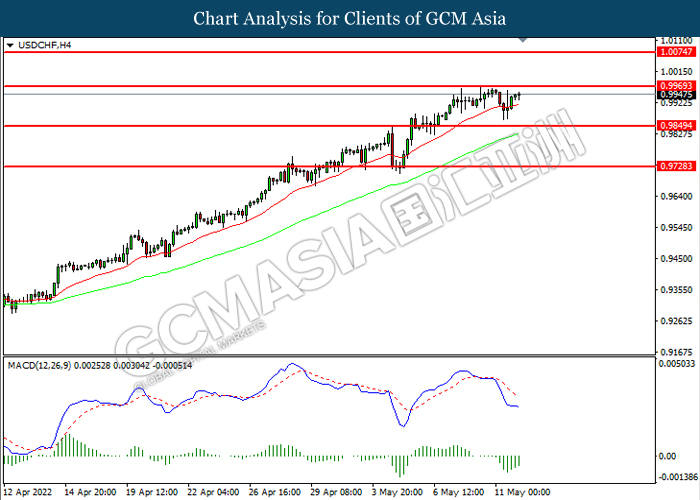

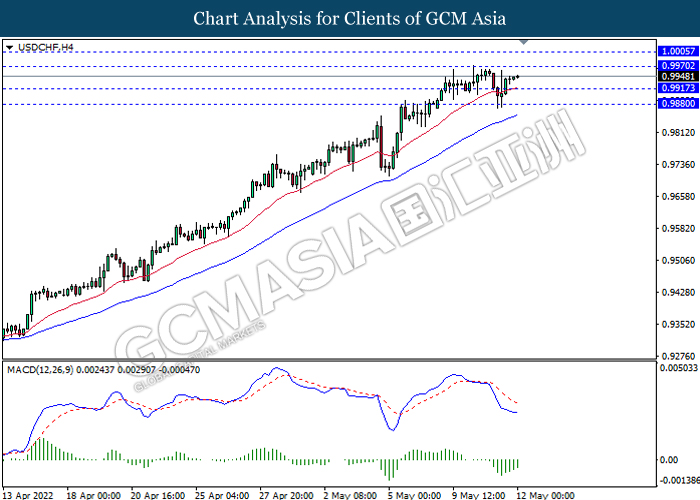

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9850, 0.9970

Support level: 0.9690, 0.9520

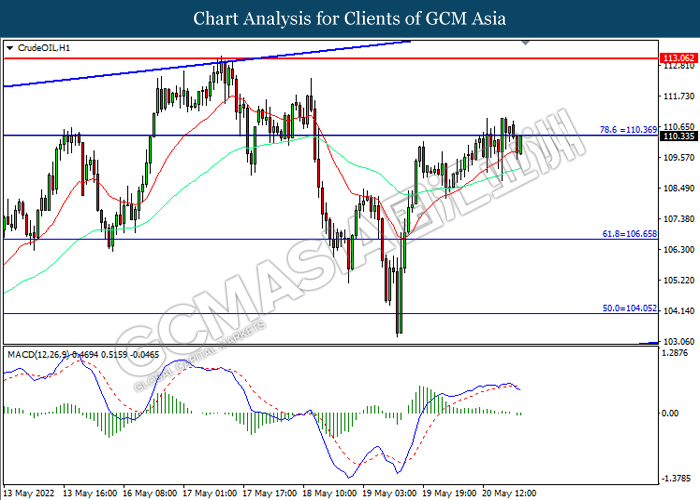

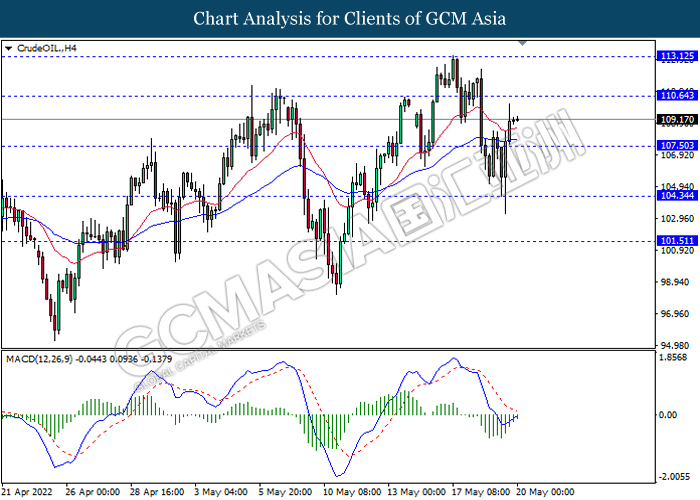

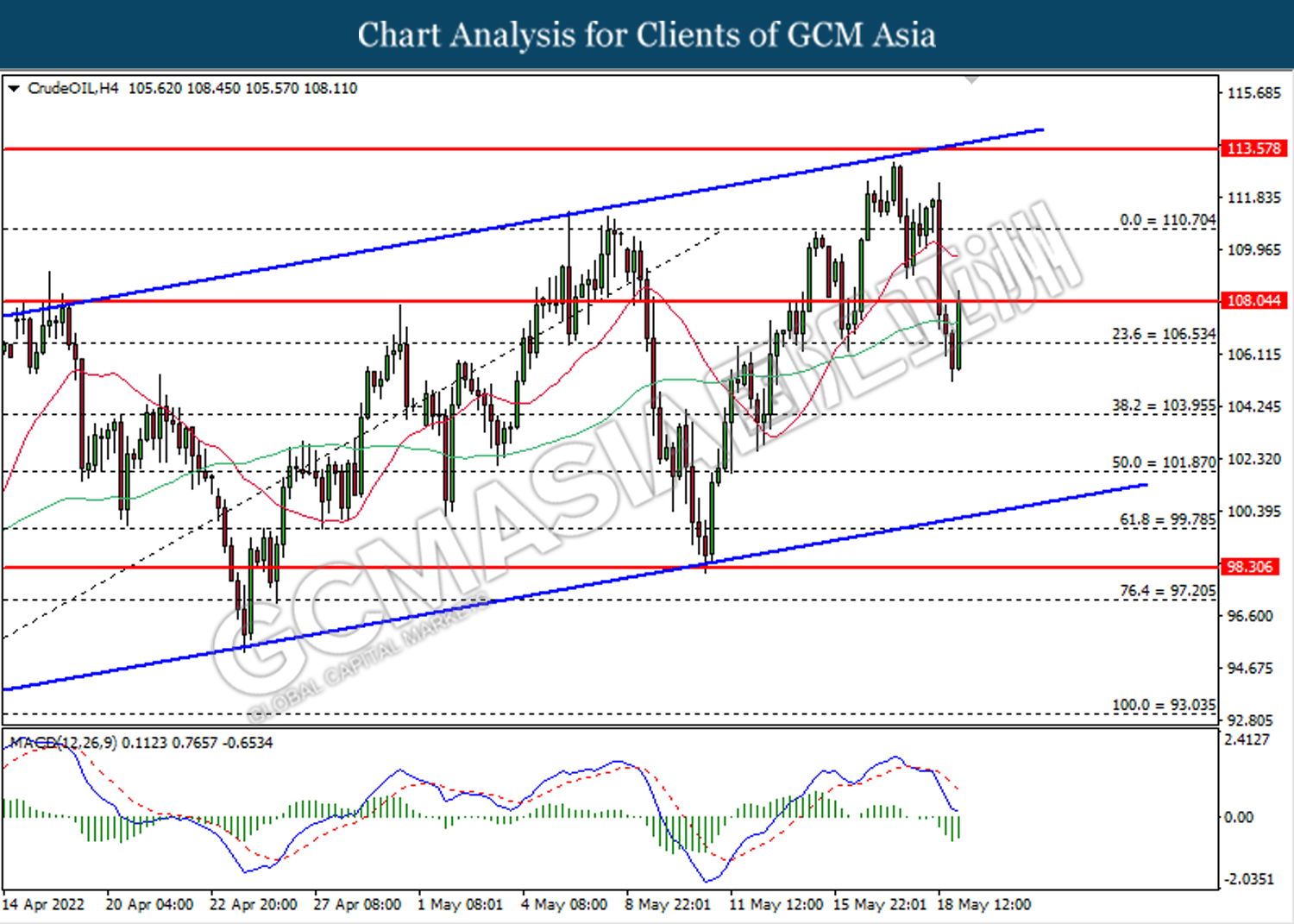

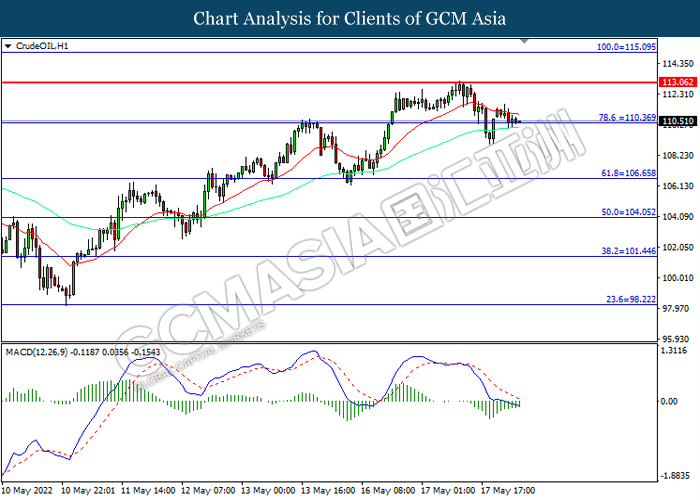

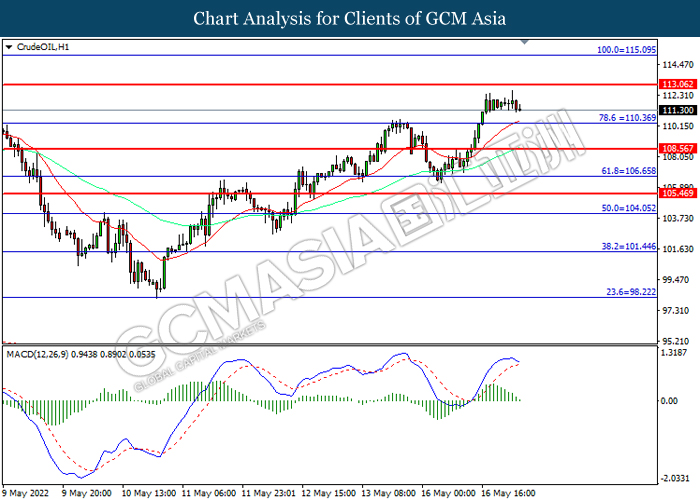

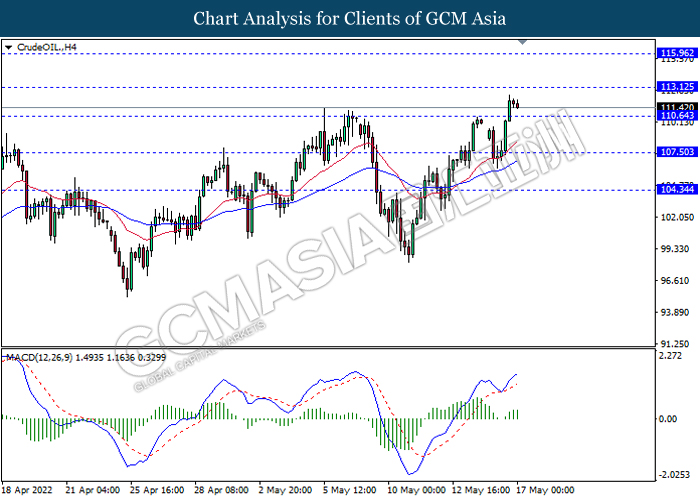

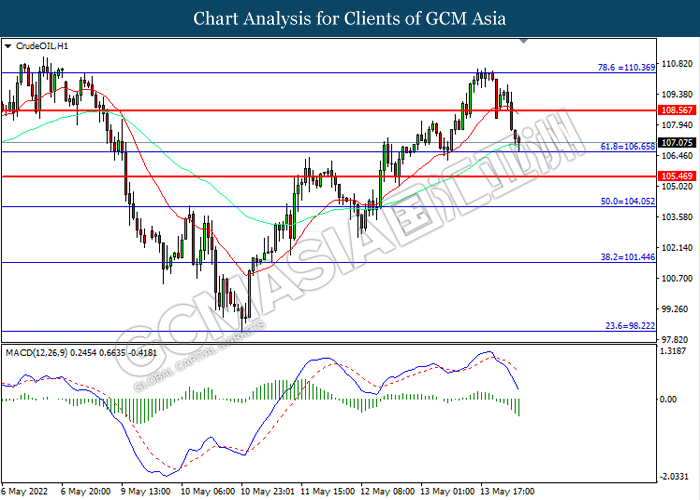

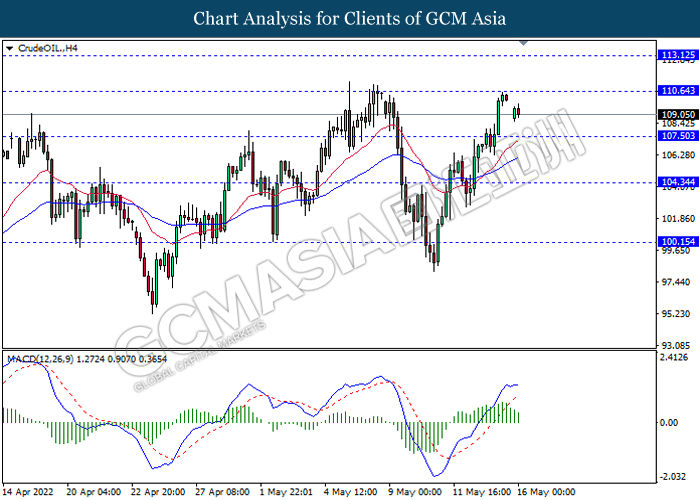

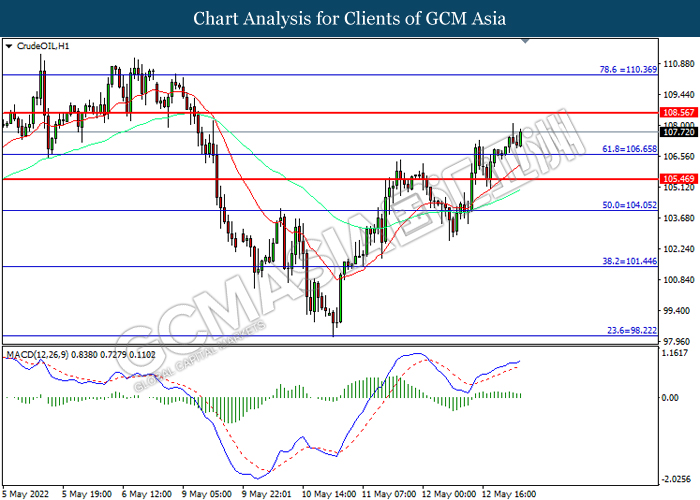

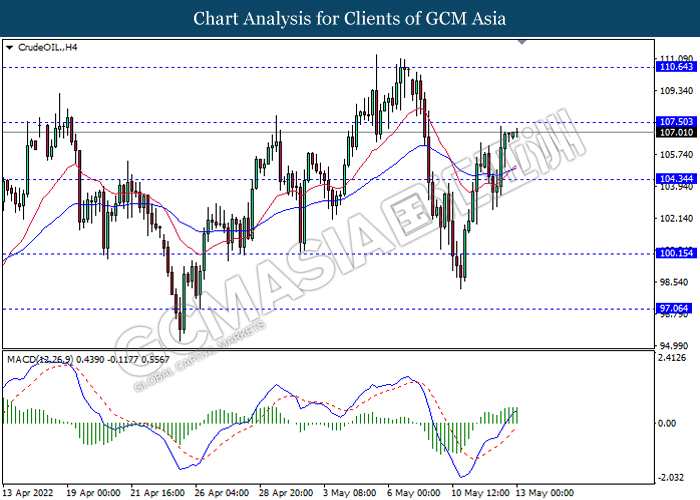

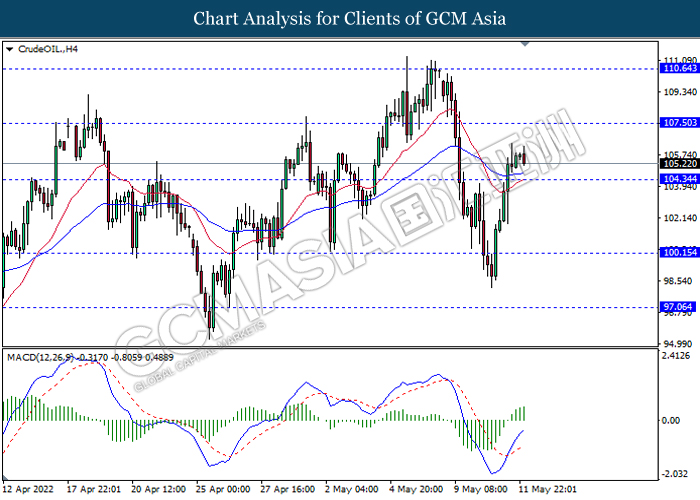

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated inceasing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 110.35, 113.05

Support level: 106.65, 104.05

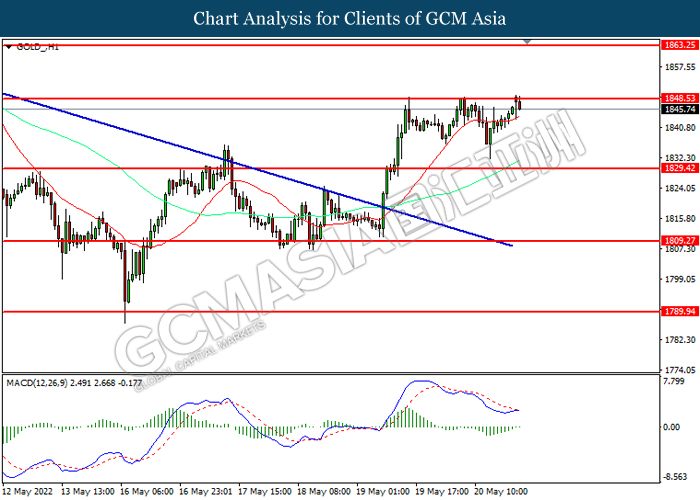

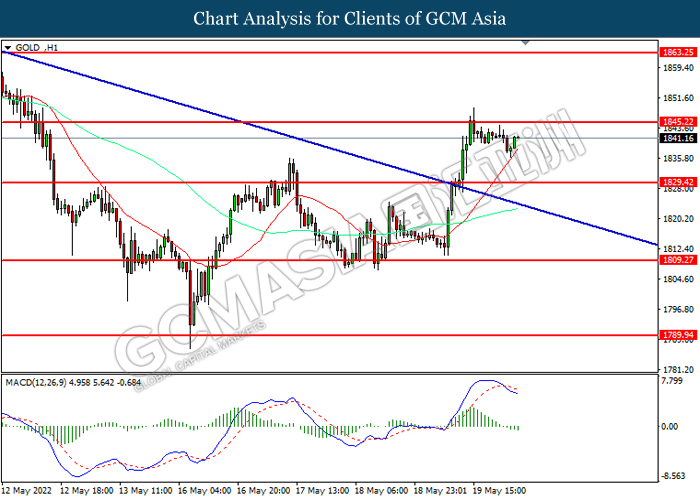

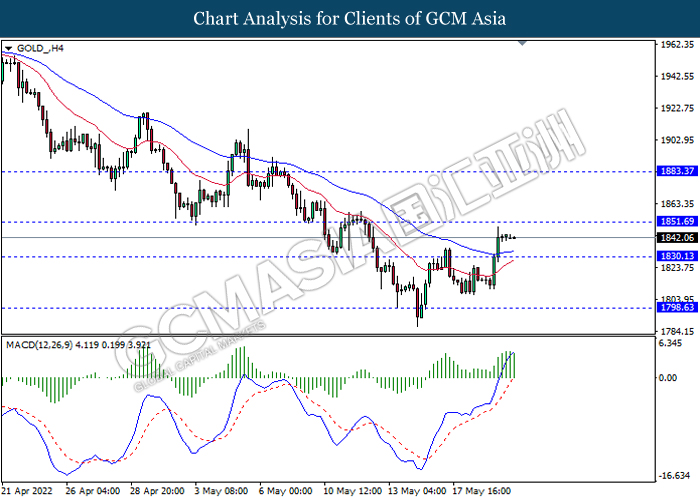

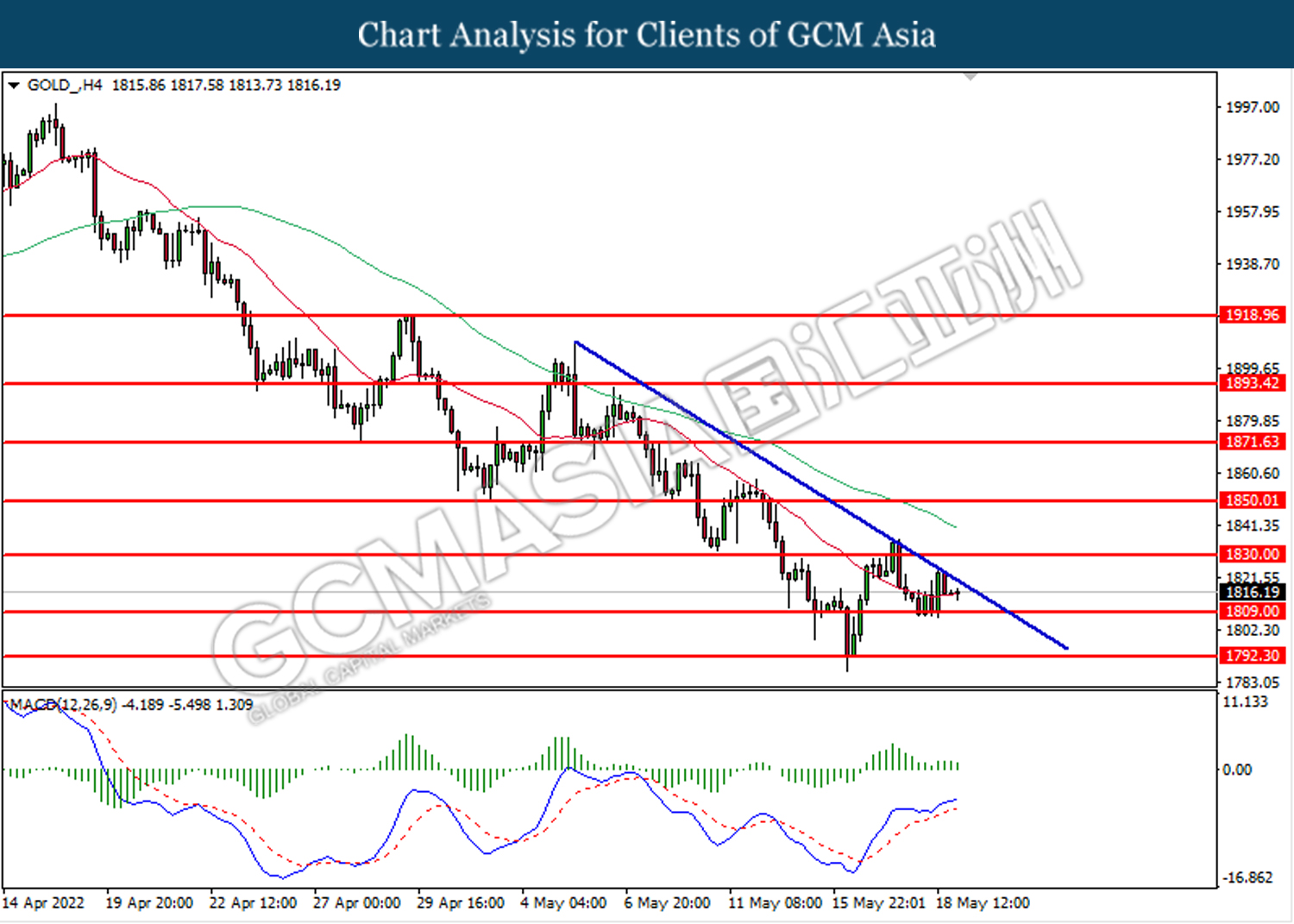

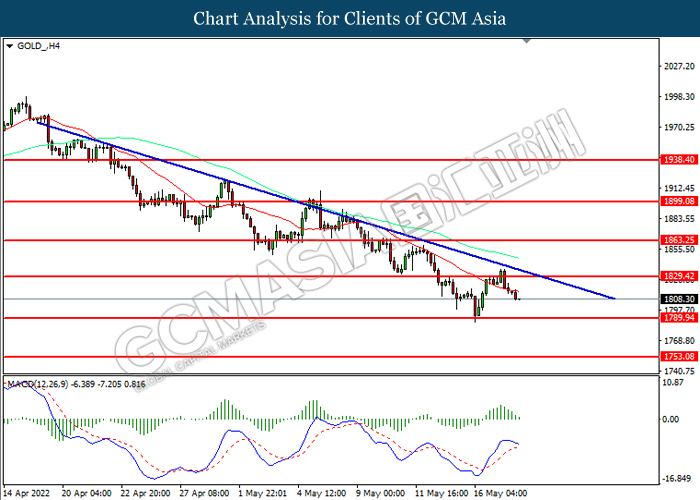

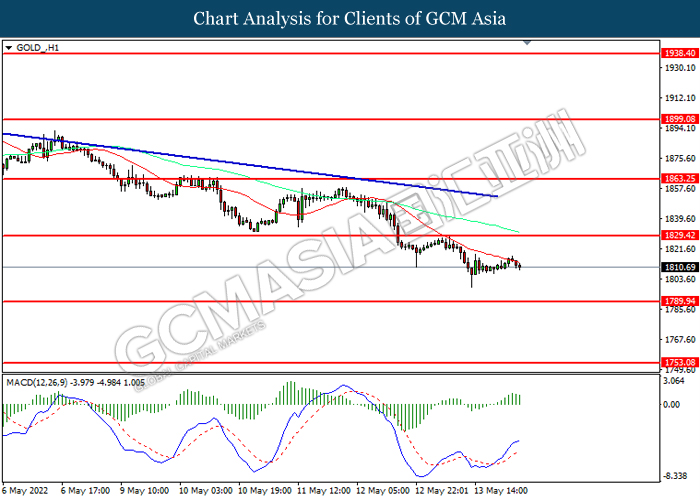

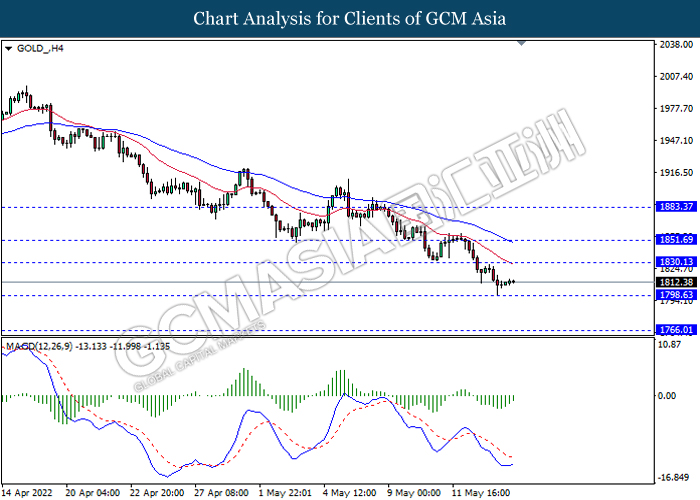

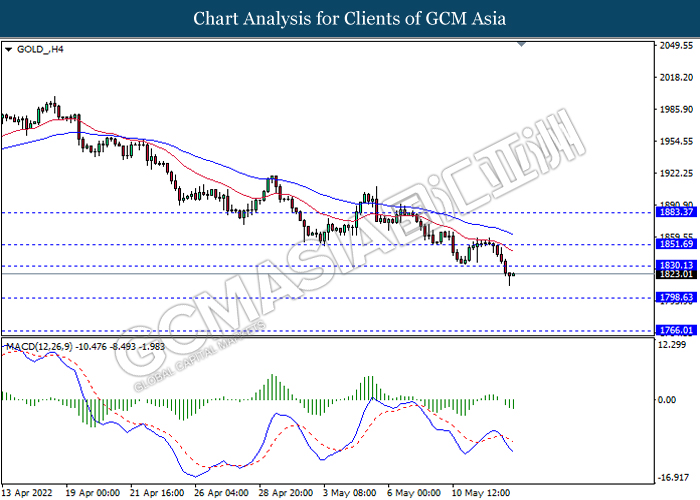

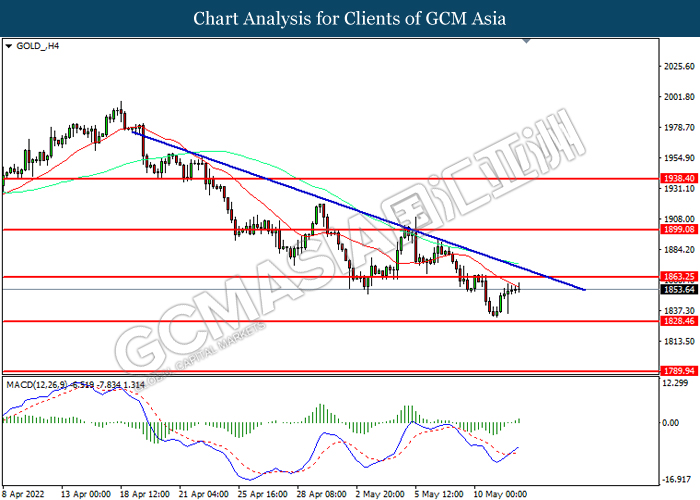

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum the extend its gains after breakout.

Resistance level: 1848.55, 1863.25

Support level: 1829.40, 1809.25

200522 Afternoon Session Analysis

20 May 2022 Afternoon Session Analysis

Aussie surged following the announcement of easing lockdown policies from China.

The Chinese-proxy currencies such as Australia Dollar surged on yesterday following the Chinese authorities started to ease the lockdown restriction. According to CNBC, more Shanghai residents were allowed to go out to shop for groceries in nearly two months. The Shanghai had recorded no new infections outside quarantined areas for fifth day in a row. Economists expected that the economic activity would start to recover with business able to operate with workers living on site while authorities allow more to resume normal operations from the beginning of June. Nonetheless, the gains experienced by the Australia Dollar was limited by the downbeat economic data. According to Australian Bureau of Statistics, Australia Employment Change notched down significantly from the previous reading of 17.9K to 4.0K, missing the market forecast at 30K. As of writing, AUD/USD depreciated by 0.47% to 0.7015.

In the commodities market, the crude oil price depreciated by 0.79% to $108.55 per barrels as of writing amid downbeat data from US region had dialled down the market optimism toward the economic progression, dragging down the appeal for this black-commodity. On the other hand, the gold price retreated 0.12% to $1839.70 per troy ounces amid technical correction. Though, the overall trend for the gold yesterday remained bullish amid the depreciation of US Dollar following the released of negative economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Apr) | -1.4% | -0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.85, 104.95

Support level: 102.45, 100.85

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2590, 1.2745

Support level: 1.2385, 1.2200

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0585, 1.0700

Support level: 1.0485, 1.0355

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its after breakout.

Resistance level: 0.7055, 0.7260

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.6400, 0.6550

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9850, 0.9970

Support level: 0.9690, 0.9520

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 110.35, 113.05

Support level: 106.65, 104.05

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1845.20, 1863.25

Support level: 1829.40, 1809.25

200522 Morning Session Analysis

20 May 2022 Morning Session Analysis

US Dollar slumped over the downbeat economic data.

The Dollar Index which traded against a basket of six major currencies eased since yesterday after the negative economic data was unleashed. According to US Department of Labor, US Initial Jobless Claims notched up from the previous reading of 197K to 218K, exceeding the market forecast of 200K, which indicating that the number of people who apply for the unemployed insurance for the first time was increased. The downbeat data hinted that the current US labor market is fragile, dialed down the market optimism toward the economic progression in US. Besides, US Existing Home Sales recorded at the reading of 5.61M, missing the market forecast of 5.65M. Existing Home Sales measures the change in the annualized number of existing residential buildings that were sold during the previous month, and the lower than expected data showed that the recession in US housing market, spurred further bearish momentum on the US Dollar. As of writing, the Dollar Index depreciated by 0.91% to 102.91.

In commodities market, crude oil price edged down by 0.66% to $109.16 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish over the market expectation that China could ease some lockdown restrictions which would boost the oil demand going forward. On the other hand, gold price appreciated by 0.04% to $1841.91 per troy ounces as of writing amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | Retail Sales (MoM) (Apr) | -1.4% | -0.2% | – |

Technical Analysis

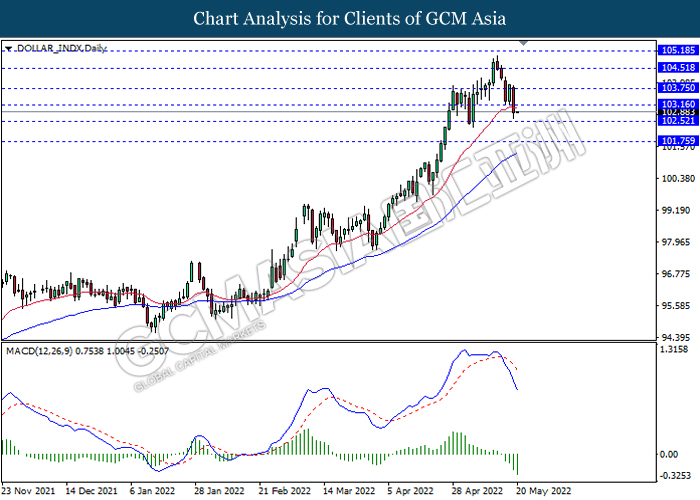

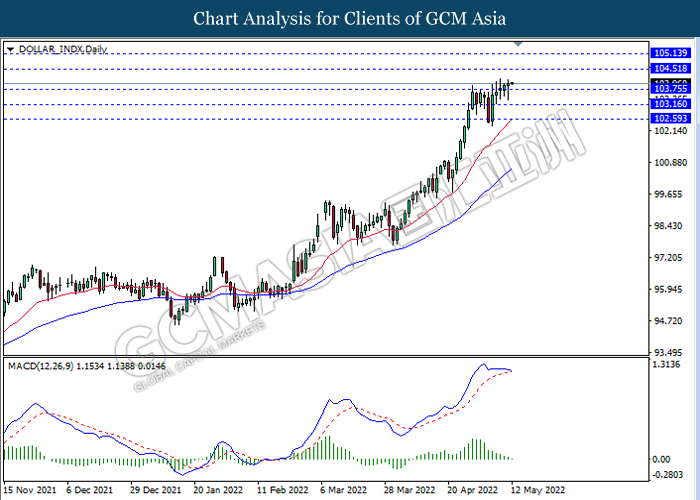

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 103.15, 103.75

Support level: 102.50, 101.75

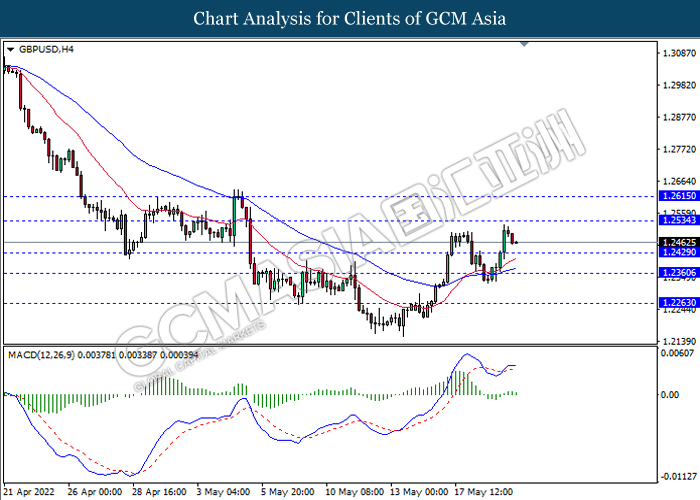

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

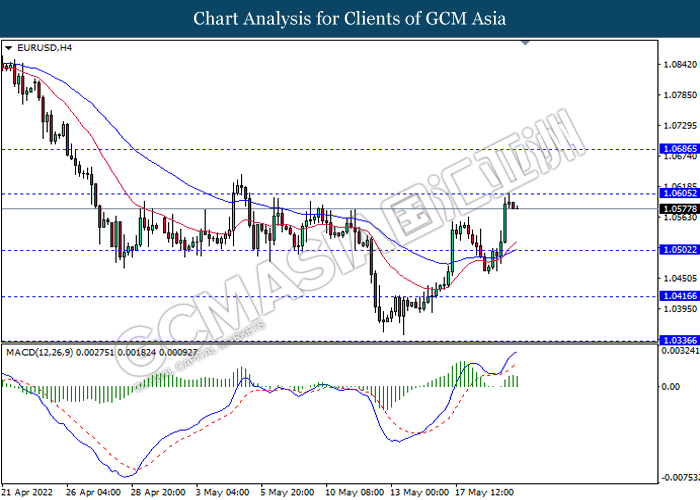

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0605, 1.0685

Support level: 1.0500, 1.0415

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7075, 0.7155

Support level: 0.6995, 0.6925

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6425, 0.6500

Support level: 0.6350, 0.6295

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9795

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1851.70, 1883.35

Support level: 1830.15, 1798.65

190522 Afternoon Session Analysis

19 May 2022 Afternoon Session Analysis

Fed’s Hawkish stance on rate hike spurred US Dollar.

The Dollar Index, which traded against a basket of six major currencies, rebounded after hitting the 1-week low level amid the high possibility of a continued rate hike over the next couple of meetings of the Federal Reserve. Early yesterday, the chairman of the Fed, Jerome Powell, reiterated his view that the Fed will continue its 50 basis point rate hike. At the same time, he also stated that the ongoing rate hike pace is appropriate, whereas they will only start to slow down the rate hike when the inflation rate is coming down in a convincing way. The hawkish stance of the Federal Reserve continued to be the tailwind for the dollar index. Besides, the sharp decline in the US stock market has hammered the market sentiment, urging investors to encash their stock holdings to avoid further losses. At this juncture, investors are still waiting for the upcoming data, such as initial jobless claims to scrutinize the further direction of the dollar index. As of writing, the dollar index slightly retraced 0.16% to 103.65.

In the commodities market, crude oil prices are up by 0.99% to $109.45 per barrel as of writing as EIA reported a draw in US oil inventories. According to the EIA Institute, US Crude Oil Inventories data came in at -3.394M, missing the economist forecast of a stockpile at 1.383M. Besides, gold prices dropped 0.02% amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | Initial Jobless Claims | 203K | 200K | – |

| 20:30 | Philadelphia Fed Manufacturing Index (May) | 17.6 | 16.7 | – |

| 22:00 | Existing Home Sales (Apr) | 5.77M | 5.62M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward the support level at 102.90.

Resistance level: 104.00, 105.00

Support level: 102.90, 102.30

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2325. However, MACD which illustrated increasing bearish momentum suggest the pair to undergo short term correction toward a lower level.

Resistance level: 1.2425, 1.2585

Support level: 1.2325, 1.2235

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0490. However, MACD which illustrated diminishing bullish momentum suggest the pair undergo short term technical correction toward a lower level.

Resistance level: 1.0490, 1.0565

Support level: 1.0440, 1.0370

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 128.80. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

AUDUSD, H4: AUDUSD was traded higher following prior rebound at the lower level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7035.

Resistance level: 0.7035, 0.7260

Support level: 0.6850, 0.6750

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6285. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6365.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2835. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2785

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9890. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9825.

Resistance level: 0.9890, 0.9980

Support level: 0.9825, 0.9725

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 108.05. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.05, 110.70

Support level: 106.55, 103.95

GOLD_, H4: Gold price was traded lower following prior retracement from the downtrend line. However, MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1809.00.

Resistance level: 1830.00, 1850.00

Support level: 1809.00, 1792.30

190522 Morning Session Analysis

19 May 2022 Morning Session Analysis

Safe-haven Dollar rallied over the market inflation concerns.

The Dollar Index which traded against a basket of six major currencies rose on Thursday over the backdrop rising inflation concern beaten down the risk-sentiment assets. According to Reuters, The mood was underscored by a 9% surge in British consumer prices and a faster-than-expected acceleration in inflation in Canada. British inflation surged to its highest annual rate since 1982 as energy bills soared, while Canadian inflation rose to 6.8% last month, largely driven by rising food and shelter prices, Statistics Canada data showed. The soaring inflation risk had dialed up the market optimism toward safe-haven products such as US Dollar, prompting investors to purchase US Dollar in order to protect their capitals. Besides, the Dollar Index extend its gains following the hawkish tone from Federal Reserve. According to CNBC, Federal Reserve Chairman Jerome Powell reiterated on Tuesday that he will back interest rate increases until prices start falling back toward a healthy level, including taking rates above neutral, spurring further bullish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.53% to 103.95.

In commodities market, crude oil price slumped by 1.20% to $105.75 per barrel as of writing amid Japan would sell around 750,000 kiloliters, or 4.72 million barrels of crude oil from its national oil reserves. On the other hand, gold price edged down by 0.13% to $1813.90 per troy ounces as of writing over the surging of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | Initial Jobless Claims | 203K | 200K | – |

| 20:30 | Philadelphia Fed Manufacturing Index (May) | 17.6 | 16.7 | – |

| 22:00 | Existing Home Sales (Apr) | 5.77M | 5.62M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.50, 105.20

Support level: 103.75, 103.15

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2430, 1.2535

Support level: 1.2345, 1.2265

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0500, 1.0605

Support level: 1.0415, 1.0335

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses if successfully breakout the support level.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6850

NZDUSD, H1: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2970, 1.3090

Support level: 1.2875, 1.2765

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9910, 0.9970

Support level: 0.9860, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 107.50, 110.65

Support level: 104.35, 101.50

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00

180522 Afternoon Session Analysis

18 May 2022 Afternoon Session Analysis

Pound Sterling surged amid optimism upon the economic momentum.

Pound Sterling surged over the backdrop of the string of upbeat economic data from UK region yesterday. According to Office for National Statistics, UK Claimant Count Change came in at only -56.9K, better than the market forecast at -42.5K. Meanwhile, UK Average Earning Index + Bonus notched up significantly from the previous reading of 5.6% to 7.0%, exceeding the market forecast at 5.4%. As both crucial economic data fared much better than market expectation, which spurring further bets by investors on further rate hike decision from Bank of England in future. On the other hand, the Euro extend its gains following the European Central Bank unleashed their hawkish tone toward the economic progression. According to Reuters, Dutch Central Bank Chief Klass Knot claimed that the ECB should increase its benchmark interest rate by at least 25 basis point in July but should not yet rule out a bigger increase. As of writing, EUR/USD appreciated by 0.02% to 1.0540 while GBP/USD surged 0.03% to 1.2489.

In the commodities market, the crude oil price eased by 0.47% to $112.05 per barrel as of writing. The oil market retreated from its higher level following United States claimed that they could ease some restrictions on Venezuela’s government, raising upbeat hopes toward the additional oil supplies in future. On the other hand, the gold price slumped 0.11% to $1813.05 per troy ounces as of writing amid the rate hike expectation from the global central bank continue to drag down the appeal for the inflation-hedging commodity such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Apr) | 7.0% | 9.1% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.5% | 7.5% | – |

| 20:30 | USD – Building Permits (Apr) | 1.870M | 1.810M | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 1.4% | 0.5% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | -0.457M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.90, 104.95

Support level: 102.45, 100.85

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2590, 1.2745

Support level: 1.2385, 1.2200

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0585, 1.0700

Support level: 1.0485, 1.0355

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 131.05, 132.65

Support level: 129.10, 127.15

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its after breakout.

Resistance level: 0.7055, 0.7260

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6400, 0.6550

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

USDCHF, H4: USDCHF was traded lower following breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9970, 1.0075

Support level: 0.9850, 0.9730

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 113.05, 115.10

Support level: 110.35, 106.65

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1829.40, 1863.25

Support level: 1789.95, 1753.10

180522 Morning Session Analysis

18 May 2022 Morning Session Analysis

China plan to ease lockdown, US Dollar slumped.

The Dollar Index which traded against a basket of six major currencies slumped since yesterday over the rising of risk-sentiment toward stock market. According to Reuters, Shanghai set out plans on Monday for the end of a painful COVID-19 lockdown that has lasted more than six weeks, heavily bruising China’s economy, and for the return of more normal life from June 1. The loosing of lockdown in China would likely to boost up the economic activities in China region, dialing up the market optimism toward China economic progression and prompting investors to shift their capitals toward China shares. Nonetheless, the overall trend for Dollar Index remained bullish following hawkish speech from Federal Reserve. According to CNBC, Federal Reserve Chairman Jerome Powell reiterated on Tuesday that he will back interest rate increases until prices start falling back toward a healthy level to get inflation down. Investors would continue to scrutinize the latest updates with regards of rate hike decision from Fed in order to gauge the likelihood movement of Dollar Index. As of writing, the Dollar Index depreciated by 0.83% to 103.34.

In commodities market, crude oil price appreciated by 1.09% to $110.83 per barrel as of writing amid China plan to loose its lockdown on June 1, which led to the surging demand on oil. Besides, gold price depreciated by 0.30% to $1813.43 per troy ounce as of writing following the rising demand on risk-appetite assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Apr) | 7.0% | 9.1% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.5% | 7.5% | – |

| 20:30 | USD – Building Permits (Apr) | 1.870M | 1.810M | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 1.4% | 0.5% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | -0.457M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.50

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2345

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0605, 1.0685

Support level: 1.0500, 1.0415

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7075, 0.7155

Support level: 0.6995, 0.6925

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6425, 0.6500

Support level: 0.6350, 0.6295

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2830, 1.2910

Support level: 1.2730, 1.2635

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9970, 1.0005

Support level: 0.9910, 0.9860

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00

170522 Afternoon Session Analysis

17 May 2022 Afternoon Session Analysis

Euro surged amid hawkish expectation upon ECB.

Euro rebounded significantly following the European Central Bank policymaker Francois Villeroy de Galhau claimed on Monday that the weakness of Euro in the currency markets could threaten the European Central Bank’s efforts to combat its inflation risk. Market participants expected that the depreciation of Euro would likely to prompt the European Central Bank to manipulate the Euro market while spurring higher possibility for the rate hike in order to attract further foreign investment into the Euro market. Villeroy claimed that the ECB governing council meeting could be expected in June while further contractionary monetary policy decision will be discussed. The Euro zone government bond yields rebounded toward recent multi-year high. Germany’s 10-year bond yield rose as much as 6.7 basis point to over 1%. Meanwhile, the money market pricing suggests investors speculated that the European Central Bank would likely to announce for a 25-basis point rate hike at ECB’s July meeting. As of writing, EUR/USD appreciated by 0.06% to 1.0440.

In the commodities market, the crude oil price surged 0.27% to $111.30 per barrel as of writing. The oil price extends its gains following the European Union’s diplomats and officials expressed optimism about reaching a deal on a phased embargo Russian oil. On the other hand, the gold price appreciated by 0.03% to $1823.00 per barrel as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Mar) | 5.4% | 5.4% | – |

| 14:00 | GBP – Claimant Count Change (Apr) | -46.9K | -38.8K | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | 1.4% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | 0.7% | 0.8% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 104.95, 106.40

Support level: 103.90, 102.45

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2385, 1.2590

Support level: 1.2200, 1.2010

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0485, 1.0585

Support level: 1.0355, 1.0205

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.05, 132.65

Support level: 129.10, 127.15

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.7055, 0.7260

Support level: 0.6910, 0.6720

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6400, 0.6550

Support level: 0.6225, 0.6070

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H1: Crude oil price was traded lower retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 113.05, 115.10

Support level: 110.35, 108.55

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1829.40, 1863.25

Support level: 1789.95, 1753.10

170522 Morning Session Analysis

17 May 2022 Morning Session Analysis

US Dollar slumped amid downbeat China economic data.

The Dollar Index which traded against a basket of six major currencies slumped since yesterday amid the backdrop of negative China economic data. According to National Bureau of Statistics of China, China Industrial Production YoY notched down from the previous reading of 5.0% to -2.9%, missing the market forecast of 0.4%. Industrial Production is used to measure the real output in manufacturers, mines, and utilities within a country. A lower than expected reading indicated that the recession economic growth in China, which would likely to bring negative prospects toward economic progression in US as China was one of the largest economy in the world. It prompted investors to shift their capitals from US Dollar into other assets. Besides, amid swelling prices, most Americans see inflation as the biggest issue facing the country, according to a survey from Pew Research. The war-driven inflation would intensify the economy recession in US, spurring further bearish momentum on US Dollar. As of writing, the Dollar Index depreciated by 0.36% to 104.24.

In commodities market, crude oil price depreciated by 0.06% to $111.75 per barrel as of writing. Nonetheless, the overall trend for crude oil price remained bullish following China’s coronavirus pandemic was receding in the hardest-hit areas, which would see the significant demand recovery on oil. On the other hand, gold price rose by 0.70% to $1826.32 per troy ounce as of writing over the easing of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Mar) | 5.4% | 5.4% | – |

| 14:00 | GBP – Claimant Count Change (Apr) | -46.9K | -38.8K | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | 1.4% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | 0.7% | 0.8% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.20

Support level: 103.75, 103.15

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2345, 1.2430

Support level: 1.2265, 1.2165

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0500, 1.0605

Support level: 1.0415, 1.0335

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6850

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6225

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2910, 1.2995

Support level: 1.2830, 1.2730

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0060, 1.0110

Support level: 1.0005, 0.9970

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00

160522 Afternoon Session Analysis

16 May 2022 Afternoon Session Analysis

Australia Dollar slumped amid bearish Chinese economic prospect.

The Chinese-proxy currencies such as Australia Dollar slumped significantly over the backdrop of downbeat prospect for the Chinese economy, dialing down the market optimism toward the Australia Dollar. According to National Bureau of Statistics, China Industrial Production notched down significantly from the previous reading of 5.0% to -2.9%, missing the market forecast at 0.4%. Such data was the lowest since China’s industrial production dropped by 25.87% in February. The China’s economic slowdown continued in April amid the implementation of Covid-19 controls continue to jeopardize the supply side industry. Besides, restriction across the country, especially the lockdown of China’s most prosperous city of Shanghai since late March, have continued to weigh down the consumer consumption, with retail sales slumping by 11.1% in April. As of writing, AUD/USD depreciated by 0.83% to 0.6880.

In the commodities market, the crude oil price depreciated by 0.90% to $107.07 per barrel as of writing amid fears upon the global economic recession continue to drag down the appeal for the crude oil demand. On the other hand, the gold price slumped 0.04% to $1810.40 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 104.95, 106.40

Support level: 103.90, 102.45

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2385, 1.2590

Support level: 1.2200, 1.2010

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0485, 1.0620

Support level: 1.0355, 1.0205

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 131.05, 132.65

Support level: 128.80, 127.15

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7055, 0.7260

Support level: 0.6870, 0.6720

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6150, 0.5920

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.3050, 1.3185

Support level: 1.2890, 1.2720

USDCHF, H1: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 108.55, 110.35

Support level: 106.65, 105.45

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1829.40, 1863.25

Support level: 1789.95, 1753.10

160522 Morning Session Analysis

16 May 2022 Morning Session Analysis

US Dollar eased following the downbeat economic data.

The Dollar Index which traded against a basket of six major currencies slumped on Monday following the downbeat economic data. According to US Department of Labor, US Initial Jobless Claims notched up from the previous reading of 202K to 203K, exceeding the market forecast of 195K. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. The higher than expected reading indicated that there were more citizens who were unemployed, which brought negative prospects toward the economic progression in US. It prompted investors to selloff US Dollar and purchase other assets which having better prospects. Nonetheless, the overall trend for Dollar Index remained bullish over the Federal Reserve claimed that it would likely to raise interest rates by 50 basic points at each of its next two meetings in June and July is sensible. Investors would continue to scrutinize the latest updates with regards of the rate hike decisions from Fed in order to receive further trading signals. As of writing, Dollar Index edged down by 0.02% to 104.62.

In commodities market, crude oil price appreciated by 0.70% to $109.40 per barrel as of writing amid the Europe proposed sanctions on Russia commodities. Besides, gold price appreciated by 0.04% to $1809.71 per troy ounce as of writing over the easing of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 105.25, 106.00

Support level: 104.50, 103.75

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2265, 1.2345

Support level: 1.2165, 1.2080

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0415, 1.0500

Support level: 1.0335, 1.0250

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6850

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2910, 1.2995

Support level: 1.2830, 1.2730

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0060, 1.0110

Support level: 1.0005, 0.9970

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00

130522 Afternoon Session Analysis

13 May 2022 Afternoon Session Analysis

Pound slumped amid negative economic data.

The Pound Sterling was traded lower over the backdrop of bearish economic data. According to Office for National Statistics, UK Gross Domestic Product YoY came in at 8.7%, missing the market forecast at 9.0%. Meanwhile, U.K. Monthly Gross Domestic Product (GDP) 3M/3M Change came in at 0.8%, which also fared worse than the market forecast at 1.0%. Such bearish data indicated that the Britain’s economy unexpectedly shrank significantly in March, marking a weak end to the first quarter of a year when the risk of recession continue to looming and spiking numbers of inflation rate. Besides, the Pound Sterling extend its losses following the International Monetary Fund unleashed their bearish tone toward the economic momentum in UK. According to Reuters, the International Monetary Fund predicts Britain will see the weakest growth and highest inflation among major advanced economies next year. As of writing, GBP/USD depreciated by 0.03% to 1.2215.

In the commodities market, the crude oil price appreciated by 0.86% to $107.80 per barrel as of writing. The oil market edged higher amid the rising tensions between Russian-Ukraine continue to spur bullish momentum on the crude oil price. On the other hand, the gold price appreciated by 0.26% to $1826.60 per troy ounces amid global inflation risk continue to insinuate demand on the inflation-hedging instrument gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 65.2 | 64.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 104.95. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.95, 106.40

Support level: 103.90, 102.45

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2385, 1.2590

Support level: 1.2200, 1.2010

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.0205.

Resistance level: 1.0510, 1.0855

Support level: 1.0205, 0.9940

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6910, 0.7055

Support level: 0.6720, 0.6510

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6150, 0.5920

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3050, 1.3185

Support level: 1.2890, 1.2720

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 108.55, 110.35

Support level: 106.65, 105.45

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1863.25, 1899.10

Support level: 1821.90, 1789.95

130522 Morning Session Analysis

13 May 2022 Morning Session Analysis

US Dollar remained bullish following Fed’s hawkish tone.

The Dollar Index which traded against a basket of six major currencies surged since Thursday over the hawkish speech from Federal Reserve. According to Reuters, Federal Reserve Chair Jerome Powell appeared a speech on Thursday, which claimed that stabilizing the prices was the “bedrock” of the economy. He reiterated that the U.S. central bank’s battle to control inflation would “include some pain” as the impact of higher interest rates is felt, but that the worse outcome would be for prices to continue speeding ahead. As the war-driven inflation risk keep hovering in the market, Fed would likely to implement another aggressive tightening monetary policy in the next FOMC meeting, says 75 basic points rate hike in order to combat inflation. The soaring interest rate would increase the risk-off return of investors, prompting investors to shift their capitals toward US Dollar which having better prospects. At the moment, investors would continue to focus on the latest updates with regards of the rate hike decisions from Fed in order to receive further trading signals. As of writing, the Dollar Index appreciated by 0.90% to 104.80.

In commodities market, crude oil price appreciated by 0.81% to $106.99 per barrel as of writing following Russia unveiled a set of sanctions on energy companies operating on the continent that could further threaten supply. Besides, gold price slumped by 0.34% to $1818.76 per troy ounce as of writing amid the surging of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 65.2 | 64.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.15, 105.75

Support level: 104.50, 103.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2265, 1.2345

Support level: 1.2165, 1.2080

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0420, 1.0505

Support level: 1.0330, 1.0250

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6925, 0.6995

Support level: 0.6850, 0.6760

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3090, 1.3165

Support level: 1.2995, 1.2910

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0060, 1.0110

Support level: 1.0005, 0.9970

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.50, 110.65

Support level: 104.35, 100.15

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00

120522 Afternoon Session Analysis

12 May 2022 Afternoon Session Analysis

Euro hovered recent low despite hawkish tone from ECB.

The Euro hovered at recent low despite European Central Bank unleashed hawkish tone toward the monetary policy in future amid the strengthening of US Dollar continue to weigh down the pair of EUR/USD. According to Financial Time, The European Central Bank President Christine Lagarde signaled that she would support increasing the ECB’s main interest rate in July, leading economists to declare that the first increase for more than a decade is almost certain to go ahead. Besides, she also reiterated that the central bank would reduce its bond buying program early in the third quarter. She added that such aggressive contractionary monetary policy for price stability would be critical in ensuring businesses and households’ expectation of future inflation did not rise further. As of writing, EUR/USD appreciated by 0.05% to 1.0516.

In the commodities market, the crude oil price depreciated by 0.82% to $104.40 per barrel as of writing over the backdrop for bearish inventory data. According to Energy Information Administration (EIA), the US Crude Oil Inventories notched up significantly form the previous reading of 1.302M to 8.487M, higher than the market forecast at -0.457M. On the other hand, the gold price appreciated by 0.12% to $1854.85 per troy ounces amid spiking inflation risk in global financial market continue to prompt investors to shift their portfolio toward safe-haven gold to hedge against the inflation risk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 USD IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q1) | 1.3% | 1.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Mar) | -0.4% | -0.5% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 194K | – |

| 20:30 | USD – PPI (MoM) (Apr) | 1.4% | 0.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.90. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it breakout the resistance level.

Resistance level: 103.90, 105.90

Support level: 102.45, 100.85

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

EURUSD, H4: EURUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7055, 0.7260

Support level: 0.6910, 0.6720

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3020. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3020, 1.3185

Support level: 1.2890, 1.2720

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9970, 1.0075

Support level: 0.9850, 0.9730

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 106.65, 110.35

Support level: 104.05, 101.45

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout the resistance level.

Resistance level: 1863.25, 1899.10

Support level: 1828.45, 1789.95

120522 Morning Session Analysis

12 May 2022 Morning Session Analysis

US Dollar edged up following upbeat inflation data.

The Dollar Index which traded against a basket of six major currencies edged up on Thursday over the upbeat inflation data. According to US Bureau of Labor Statistics, US Core Consumer Price Index (CPI) MoM notched up from the previous reading of 0.3% to 0.6%, exceeding the market forecast of 0.4%. Core Consumer Price Index (CPI) is used as an indicator to present the changes in purchasing trends and inflation of a country, which measuring the changes in the price of goods and services and excluding food and energy. A higher inflation data would likely to increase the odds of rate hike from Federal Reserve, sparkling the appeal for the US Dollar. Nonetheless, the gains experienced by Dollar Index was limited following the market participants were expecting that April’s CPI report is expected to show inflation has already reached a peak, according to CNBC. As inflation risk was easing, Fed would less likely to implement aggressive tightening monetary policy, says 0.75% rate hike in the next FOMC meeting in order to combat inflation risk, which spurred bearish momentum in the US Dollar. As of writing, the Dollar Index appreciated by 0.08% to 104.02.

In commodities market, crude oil price eased by 0.04% to $105.67 per barrel as of writing. However, the overall trend for crude oil price remained bullish amid Russia sanctioned some European gas companies, adding to uncertainty in world energy markets. On the other hand, gold price depreciated by 0.01% to $1853.65 per troy ounce as of writing following the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 USD IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q1) | 1.3% | 1.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Mar) | -0.4% | -0.5% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 194K | – |

| 20:30 | USD – PPI (MoM) (Apr) | 1.4% | 0.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.50, 105.15

Support level: 103.75, 103.15

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2265, 1.2345

Support level: 1.2165, 1.2080

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6925, 0.6995

Support level: 0.6850, 0.6760

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3065, 1.3165

Support level: 1.2995, 1.2910

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9970, 1.0005

Support level: 0.9915, 0.9880

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.50, 110.65

Support level: 104.35, 100.15

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1883.35, 1917.85

Support level: 1851.70, 1830.15