110522 Afternoon Session Analysis

11 May 2022 Afternoon Session Analysis

Antipodean currencies slumped amid bearish China economic outlook.

The Chinese-proxy currencies such as Australia Dollar and New Zealand Dollar extend their losses following the rising inflation risk in China continue to spark higher cost for their major trade partner. The China’s consumer prices surged significantly last month amid the logistic disruption caused by strict Covid-19 lockdown. According to the National Bureau of Statistics (NBS), the official consumer price index (CPI) in China rose significantly by 2.1% in April from a year earlier, up from the previous reading of 1.5% in March. The food prices in China also rose by 1.9% last month compared to a year earlier. Meanwhile, the official producer price index (PPI) rose by 8% in April from a year earlier, which also fared higher than the market expectation at 7.7%. The above-estimate Chinese consumer and producer price inflation data, reflecting the supply chain disruption issues in China, which also dialing down further market optimism toward the economic momentum in Australian and New Zealand. As of writing, AUD/USD depreciated by 0.03% to 0.6950 and NZD/USD slumped 0.02% to 0.6328.

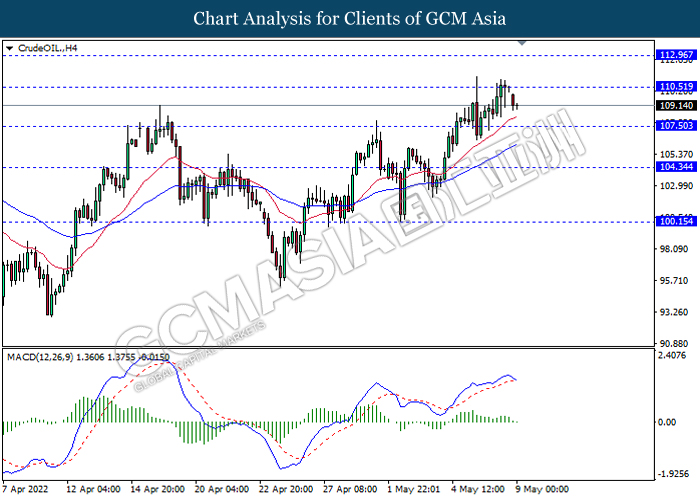

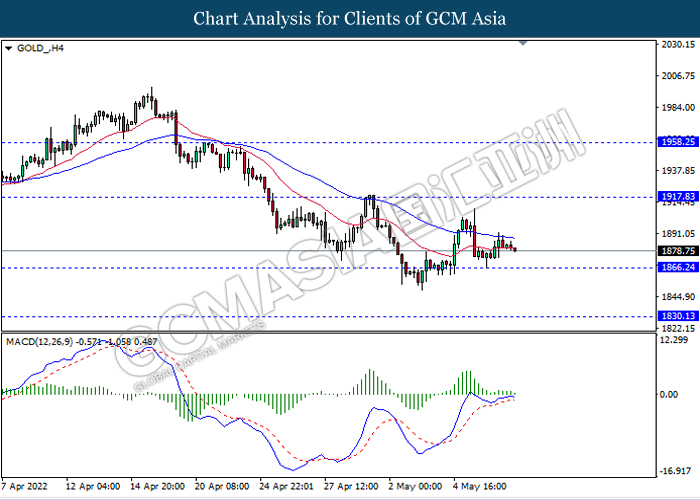

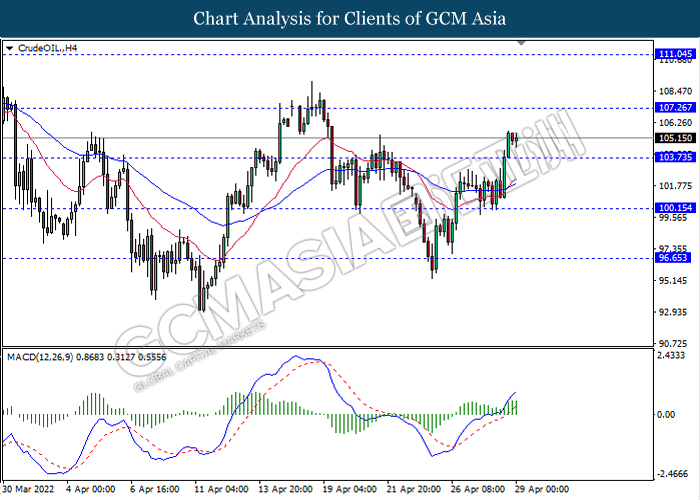

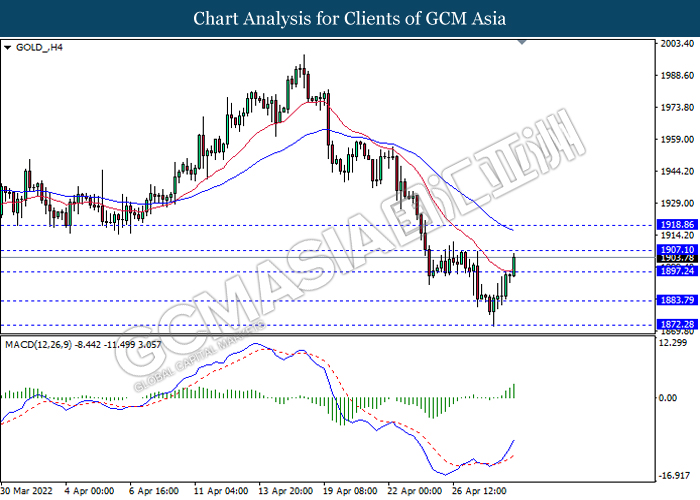

In the commodities market, the crude oil price appreciated by 2.03% to $101.45 per barrel as of writing. The oil market edged higher mostly due to technical correction. Nonetheless, investors would continue to scrutinize the latest updates with regards of further China and US economic data to gauge the likelihood prospect for the global economic growth to determine the demand outlook for this black-commodity. On the other hand, the gold price depreciated by 0.08% to $1837.00 per troy ounces as of writing amid rate hike expectation from global central bank.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.3% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (Apr) | 1.2% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 1.302M | -0.829M | – |

Technical Analysis

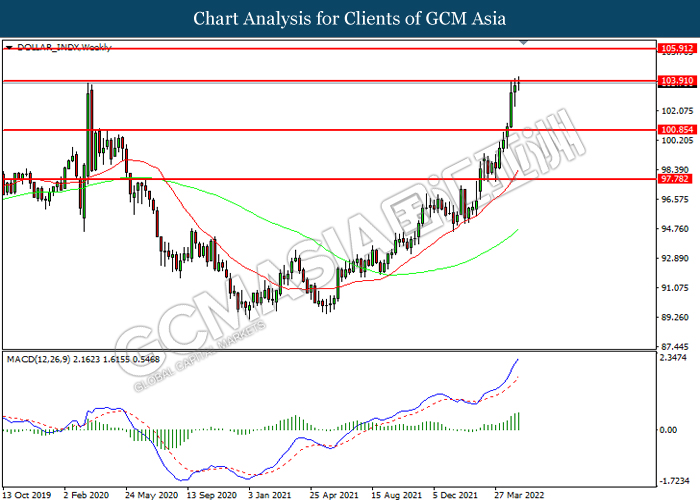

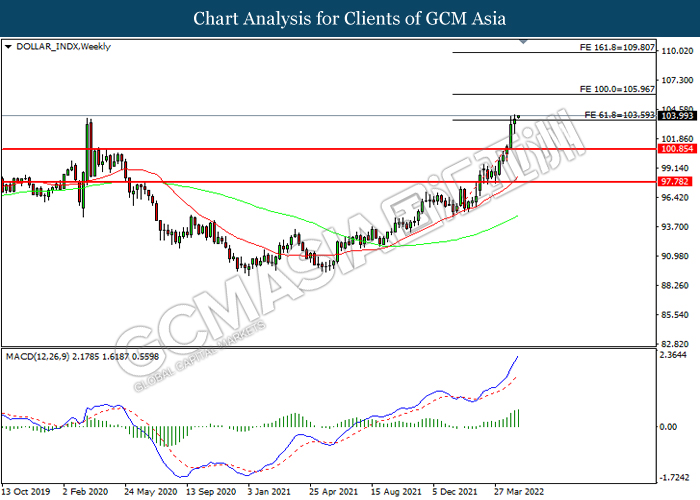

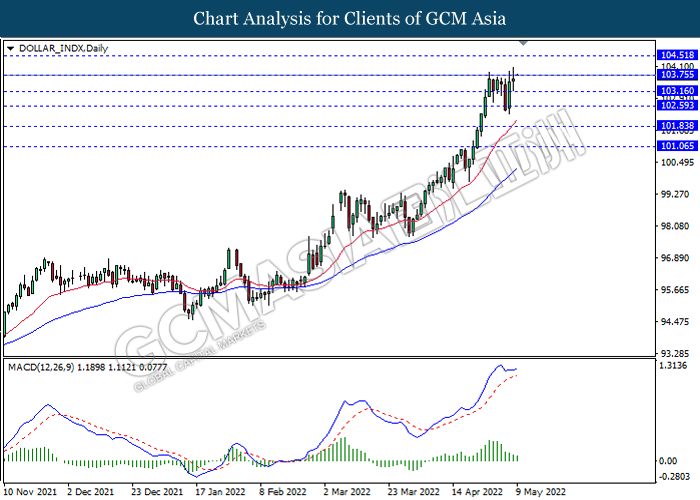

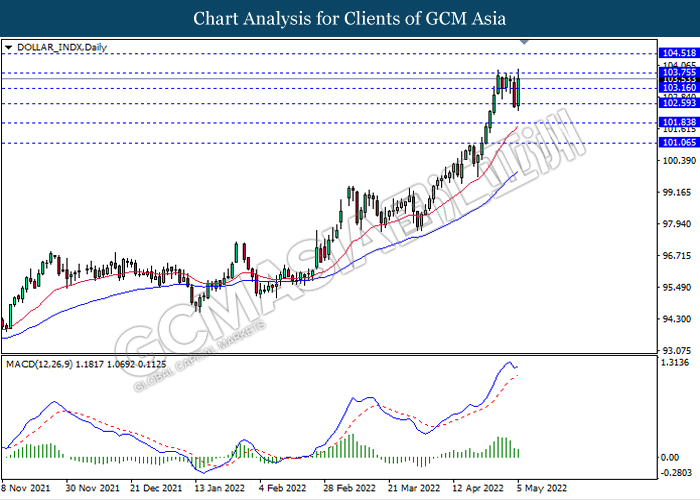

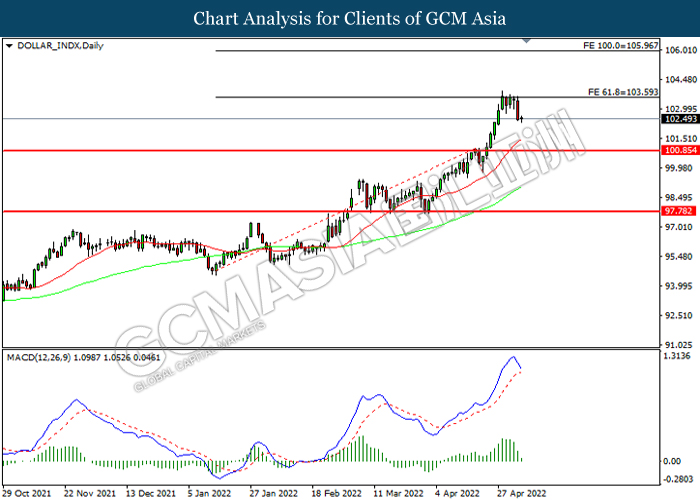

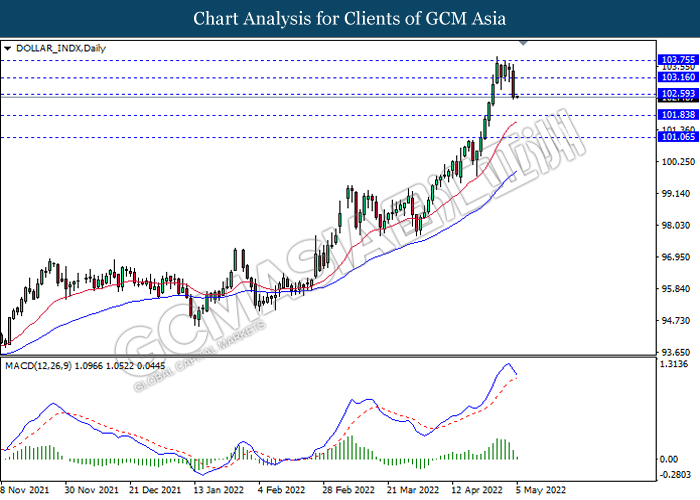

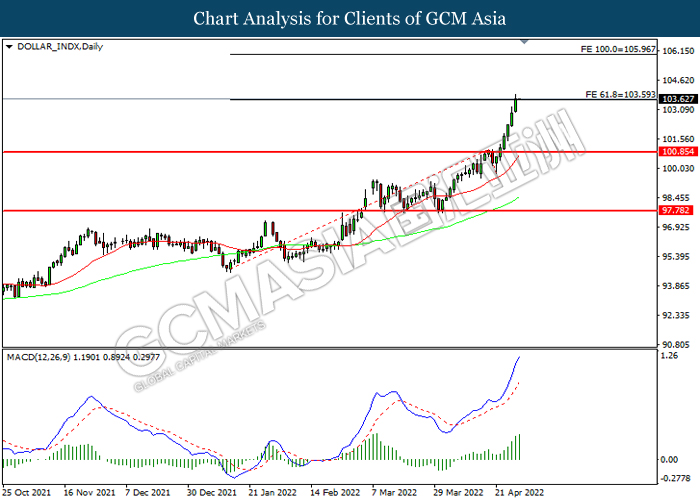

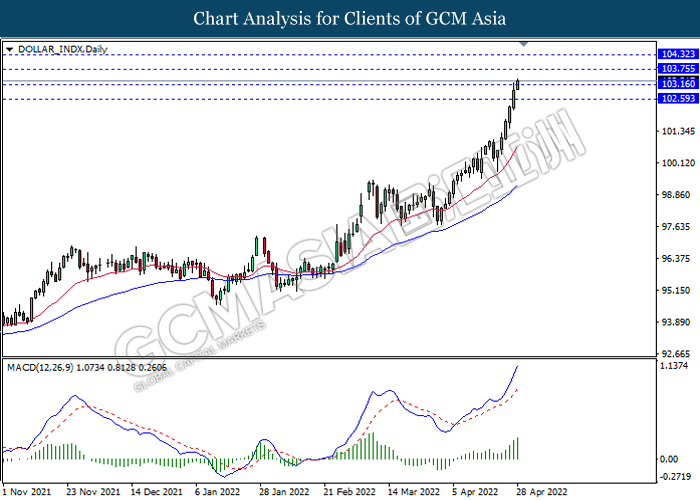

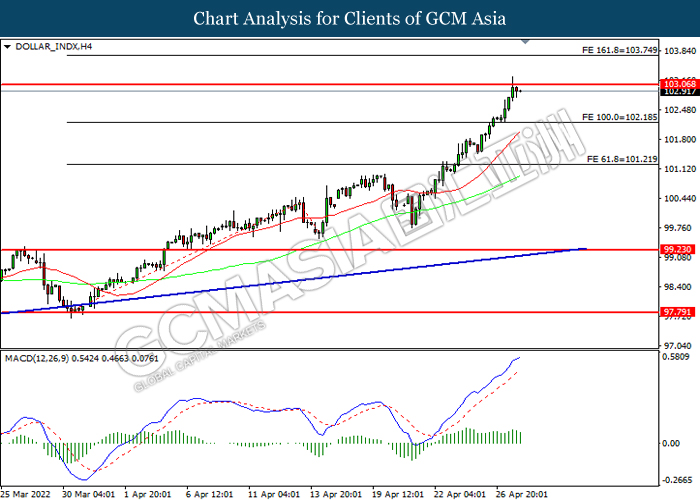

DOLLAR_INDX, Weekly: Dollar index was traded higher while currently testing the resistance level at 103.90. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it breakout the resistance level.

Resistance level: 103.90, 105.90

Support level: 100.85, 97.80

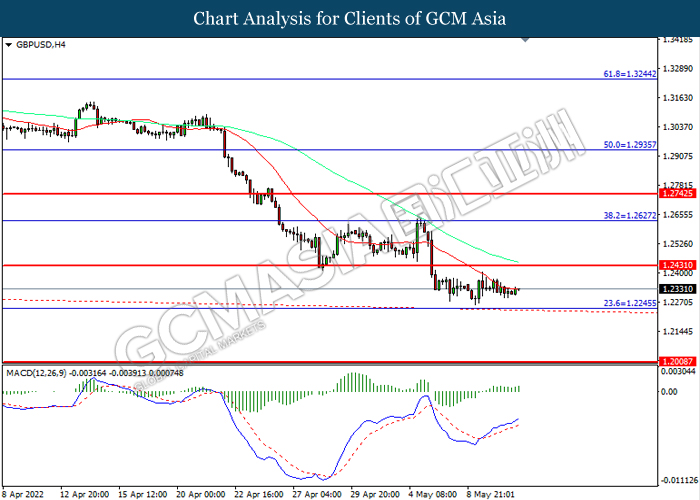

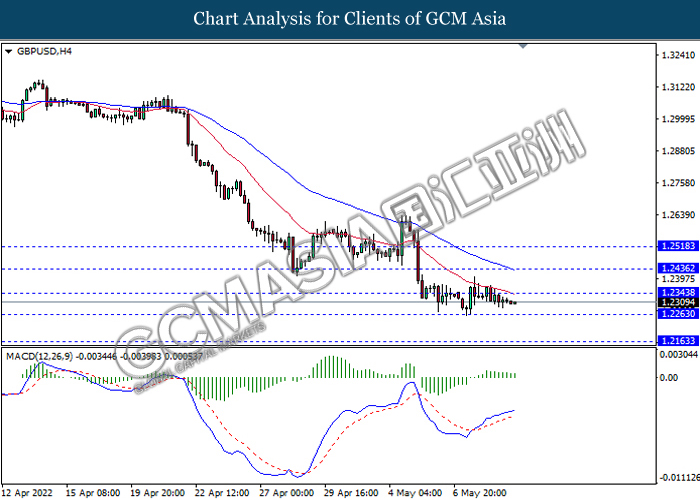

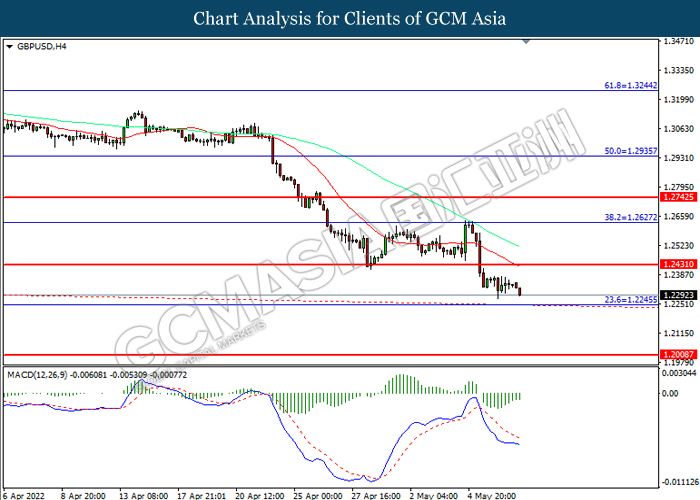

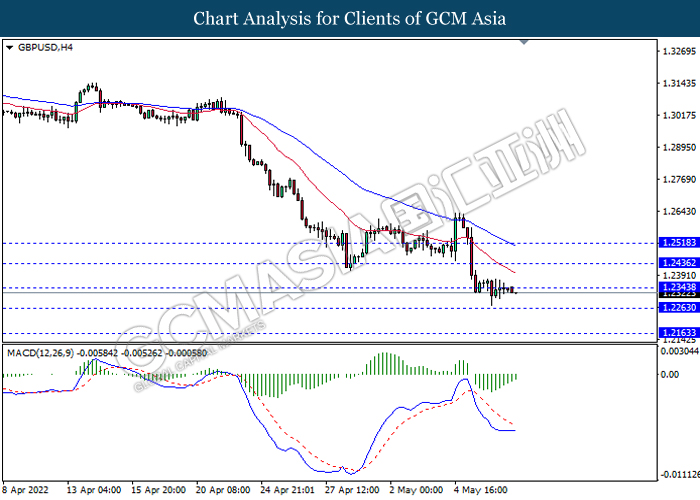

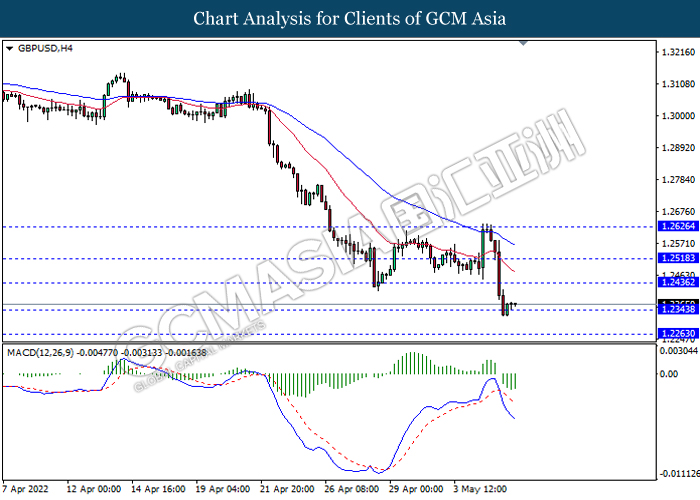

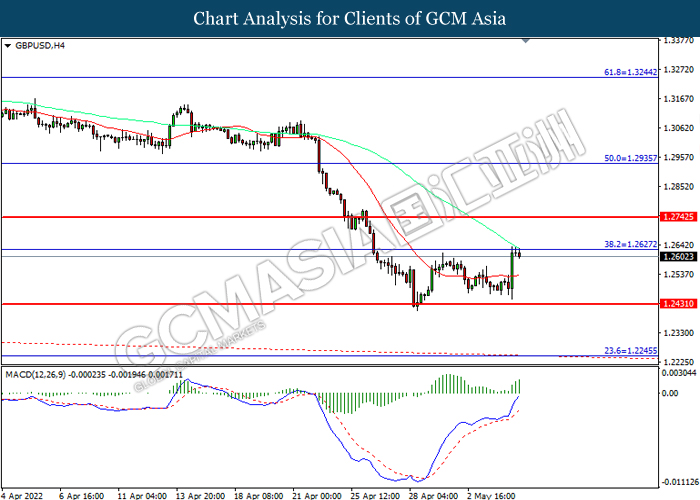

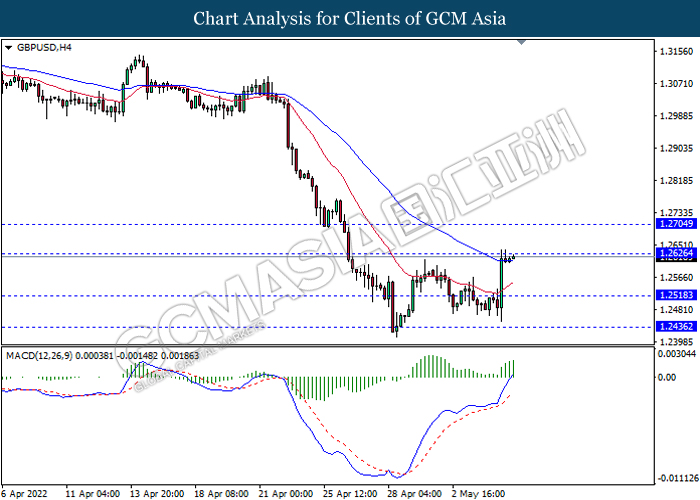

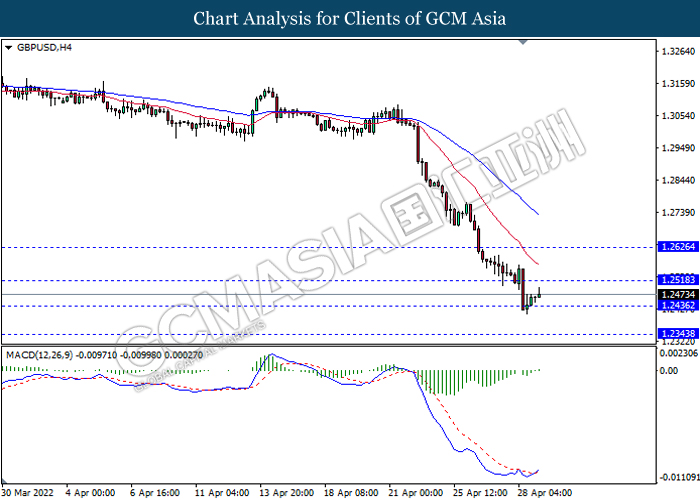

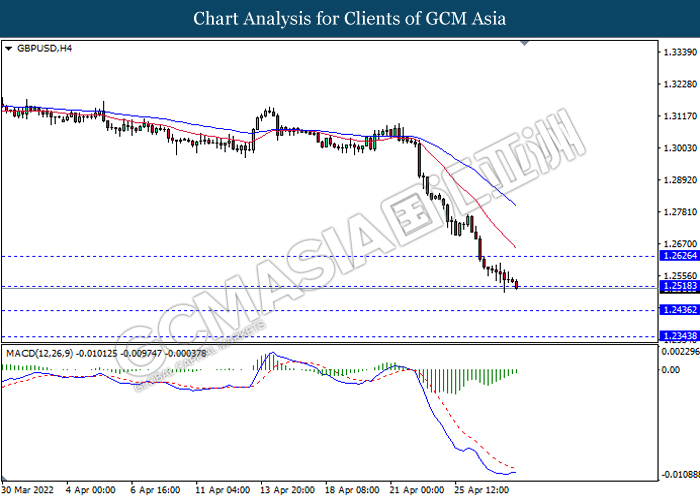

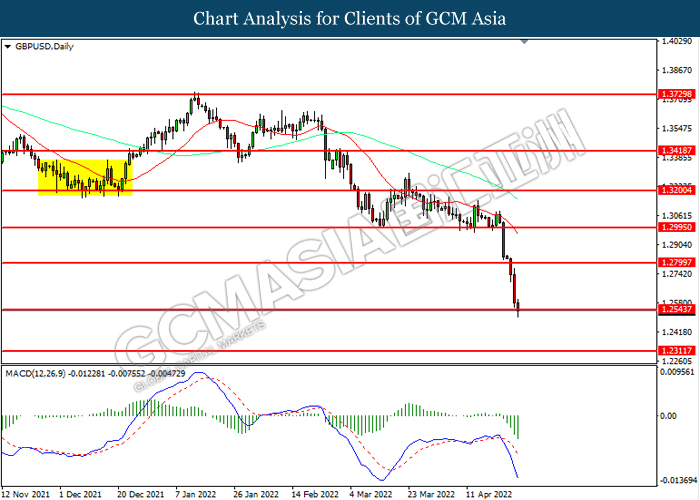

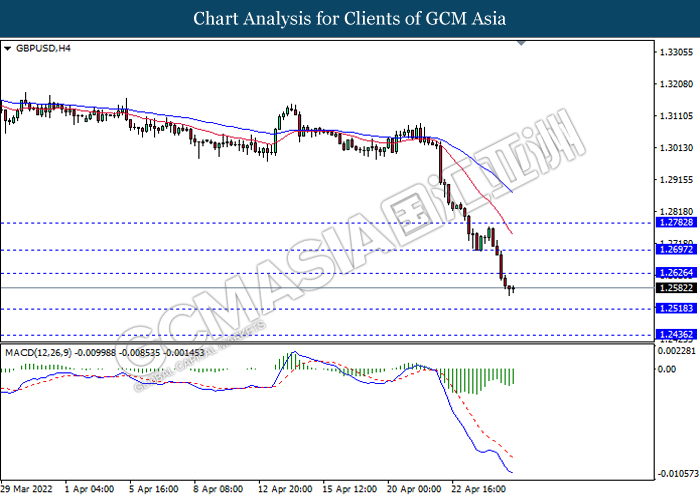

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

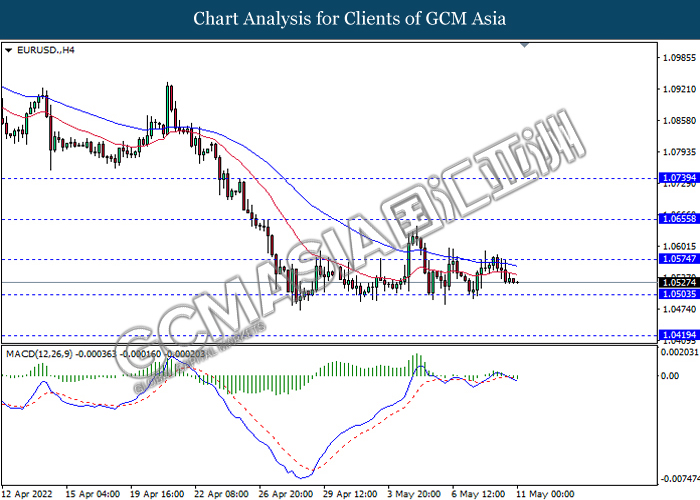

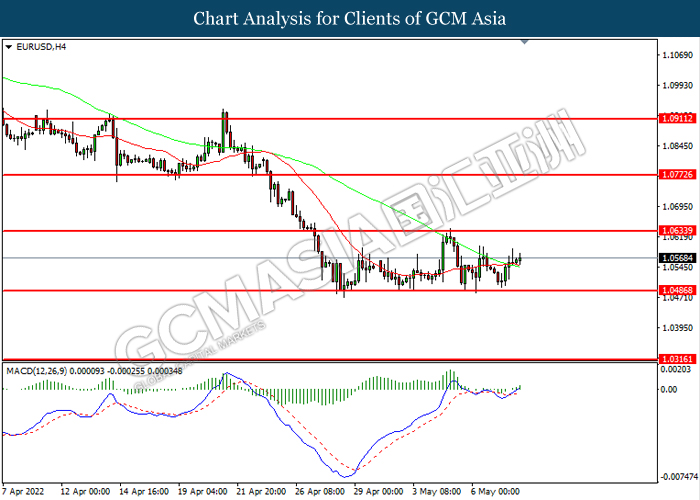

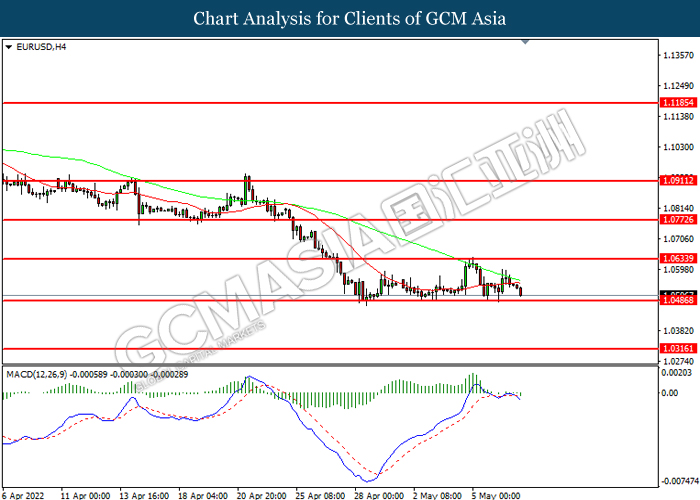

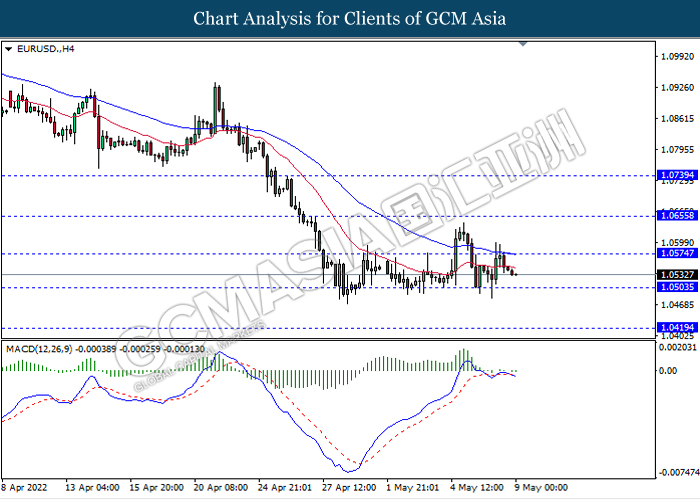

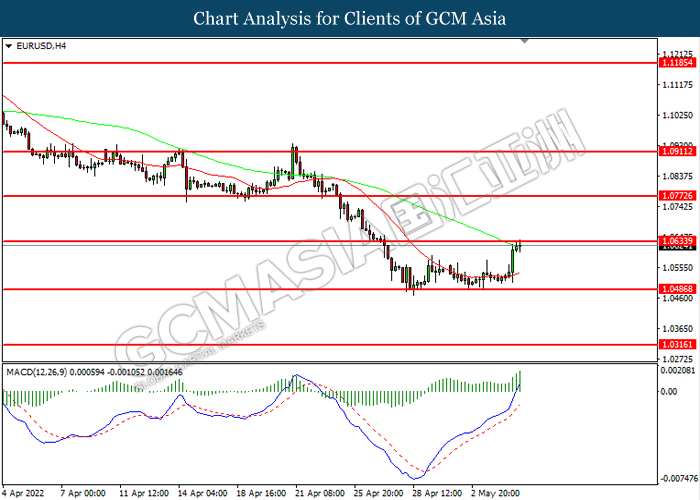

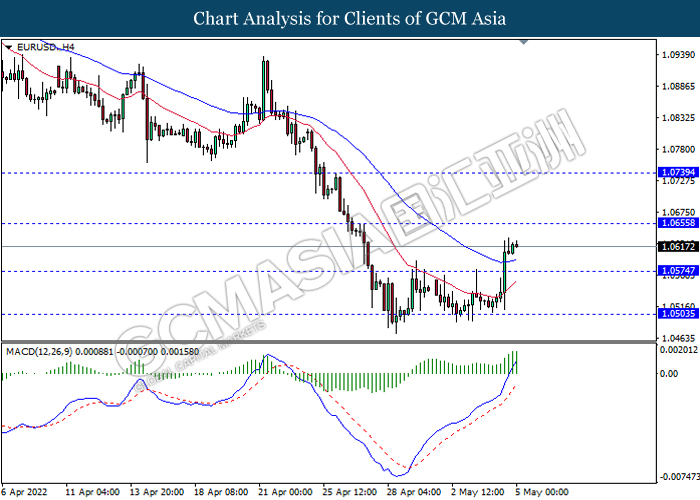

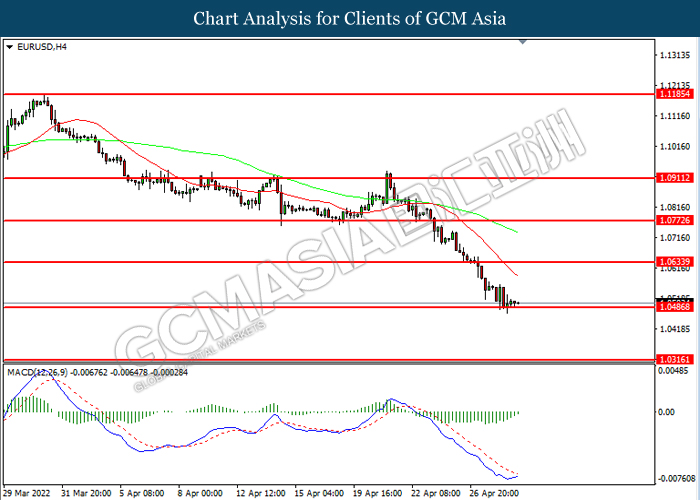

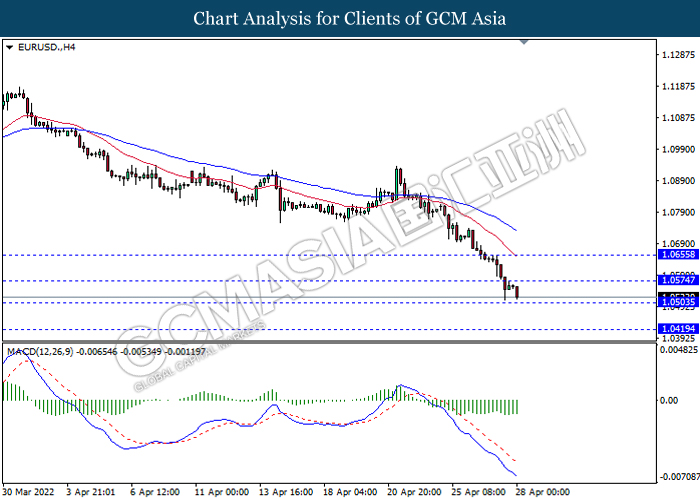

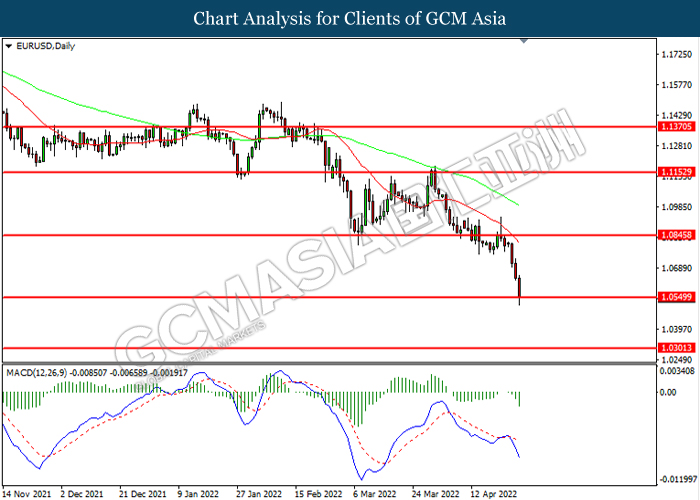

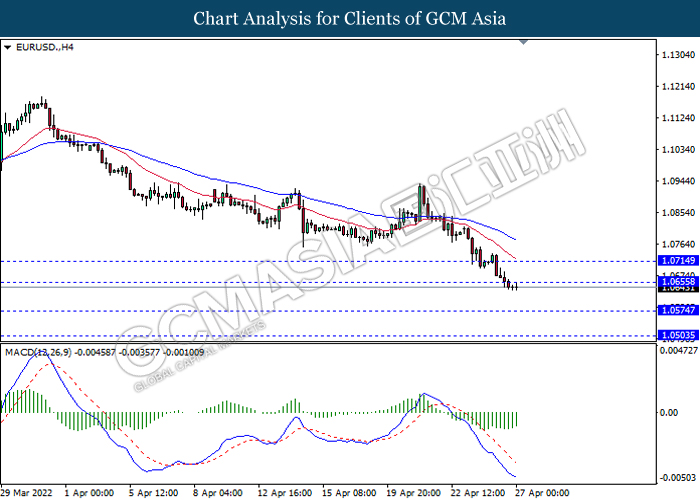

EURUSD, H4: EURUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

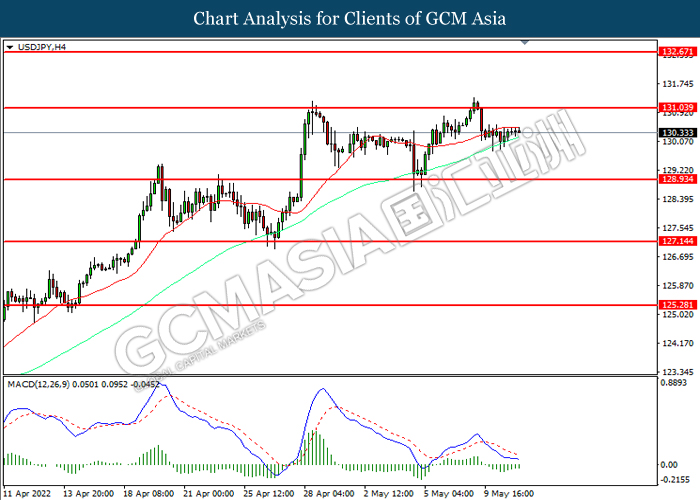

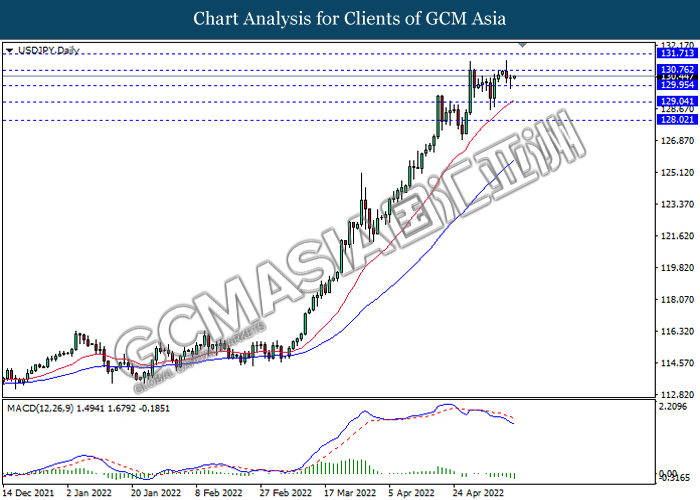

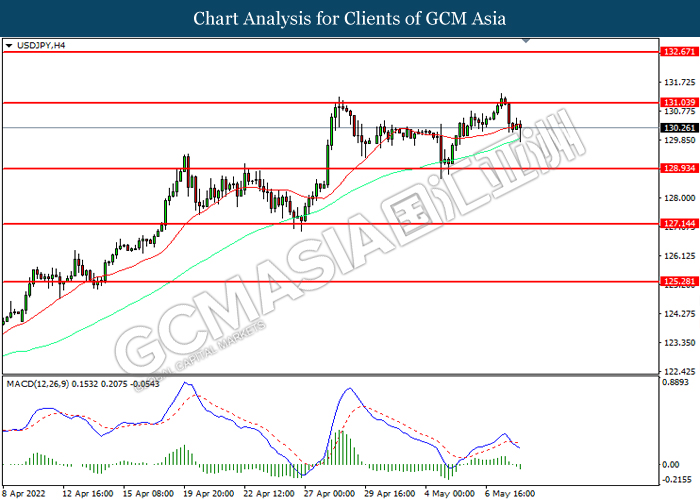

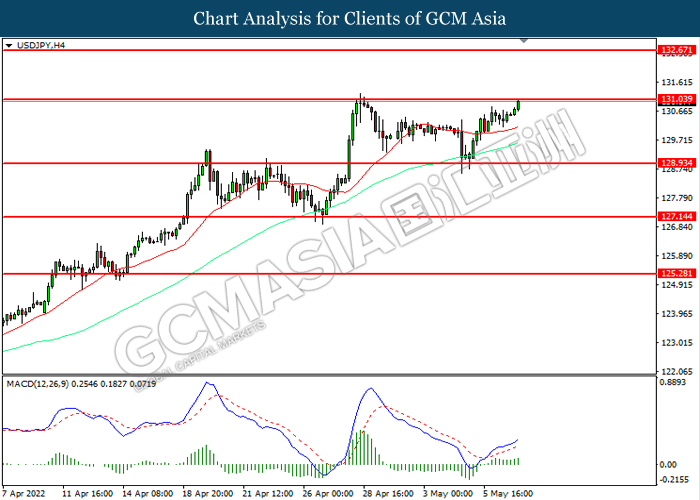

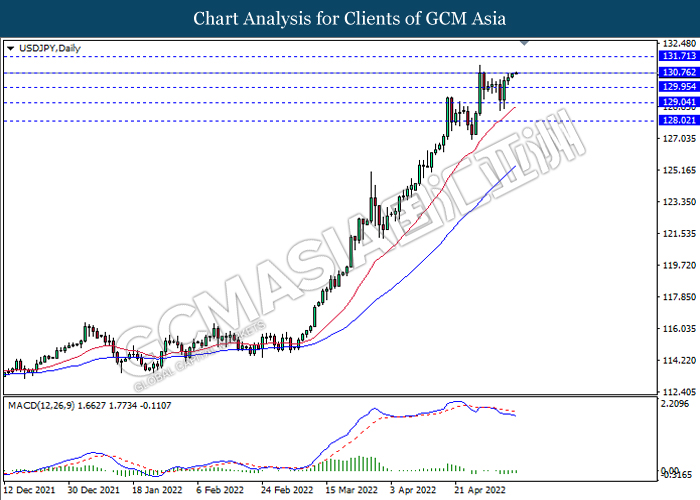

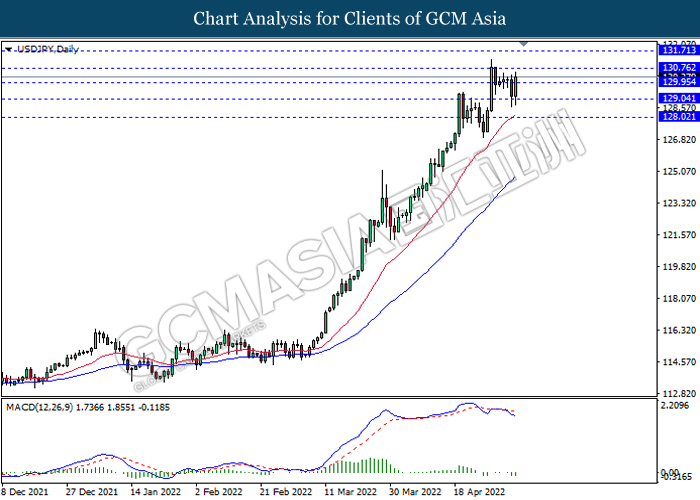

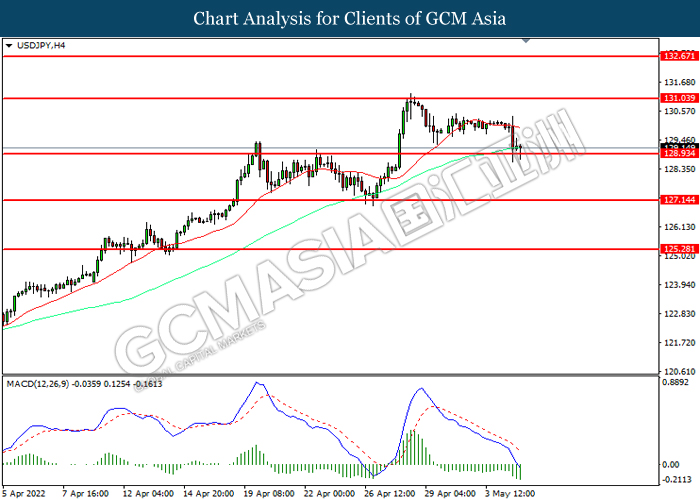

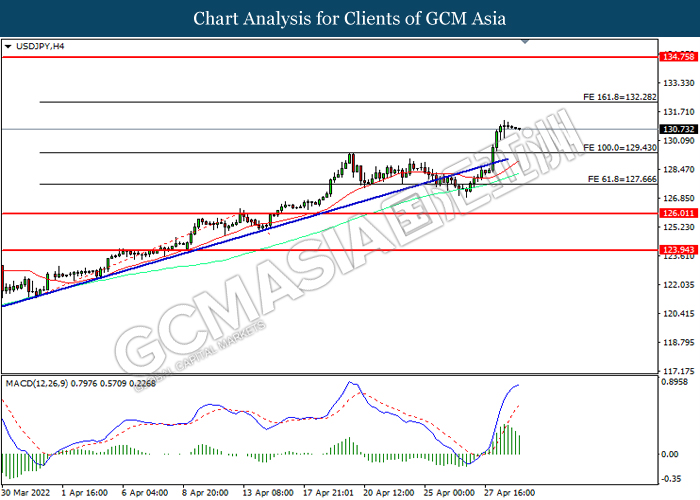

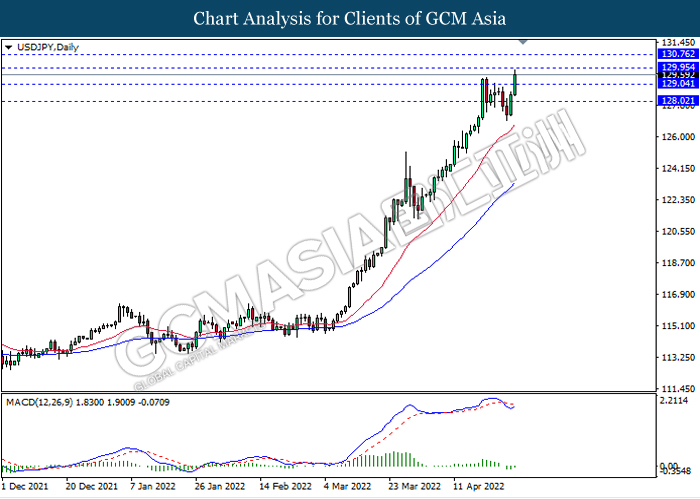

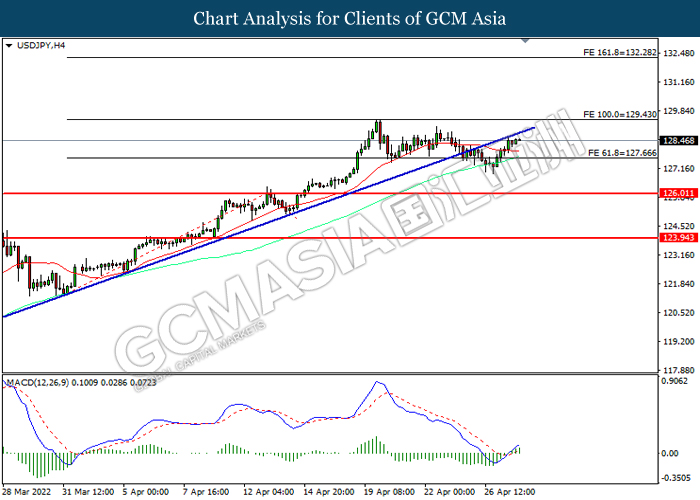

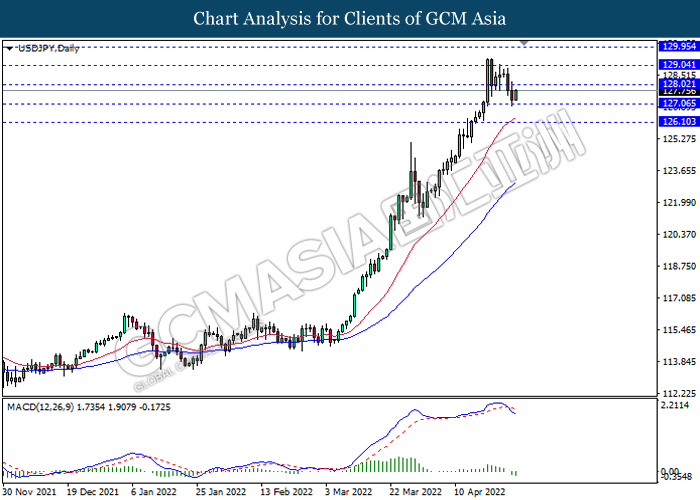

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

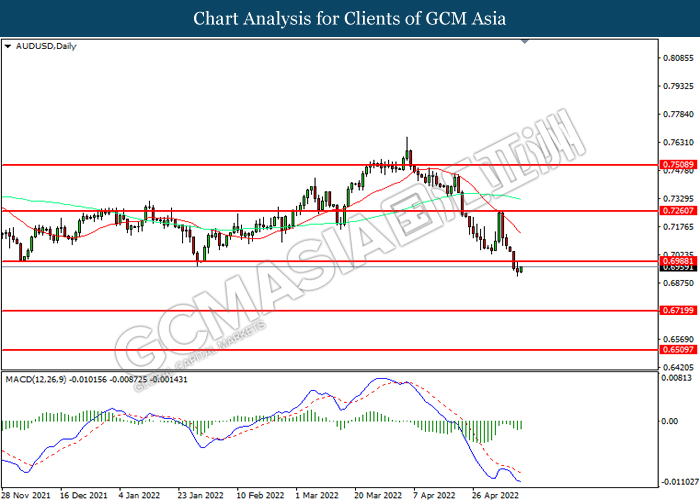

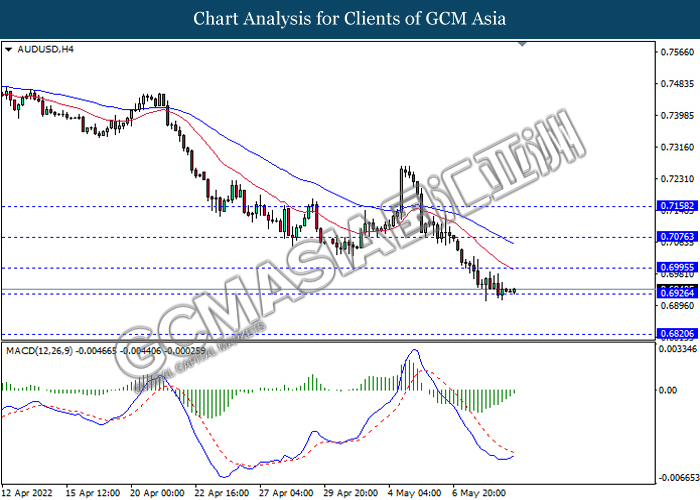

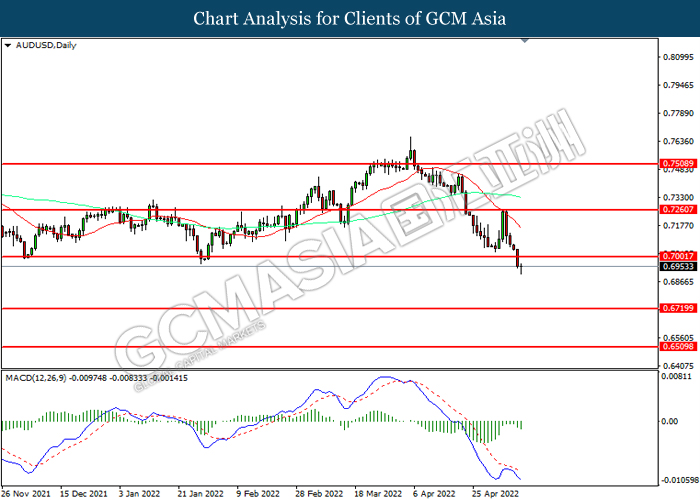

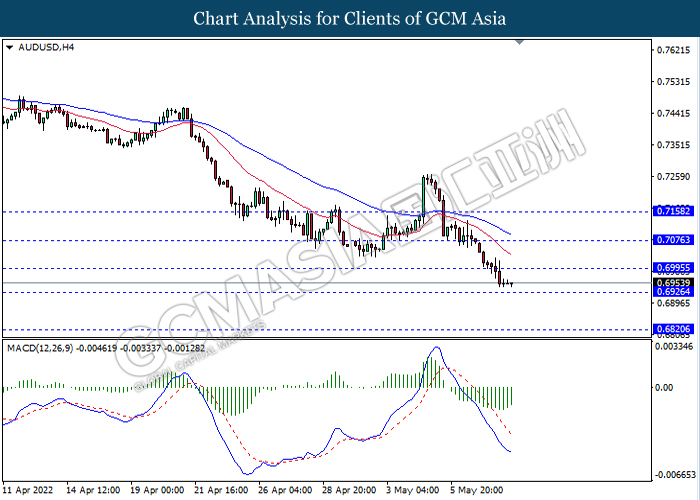

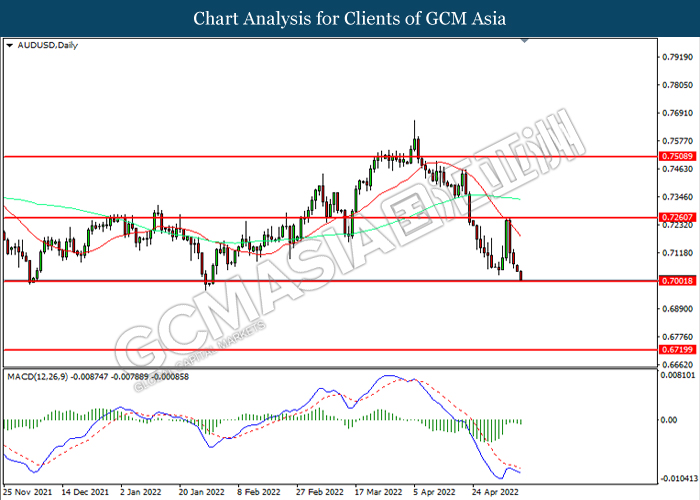

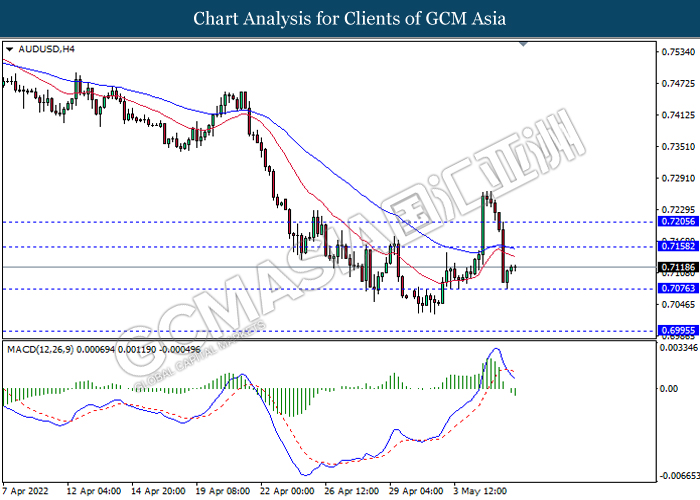

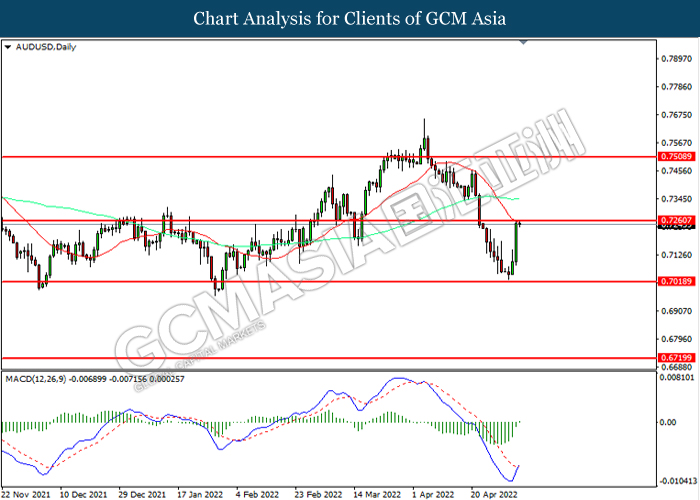

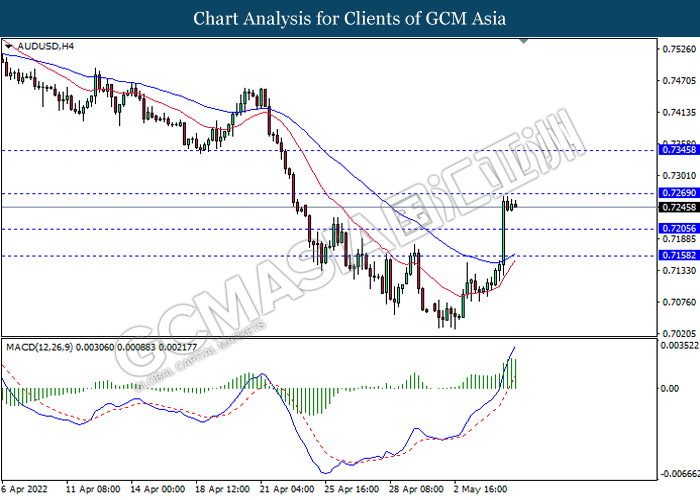

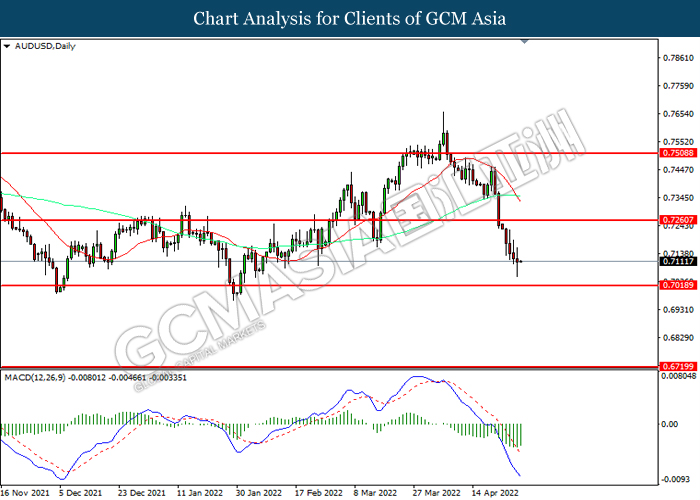

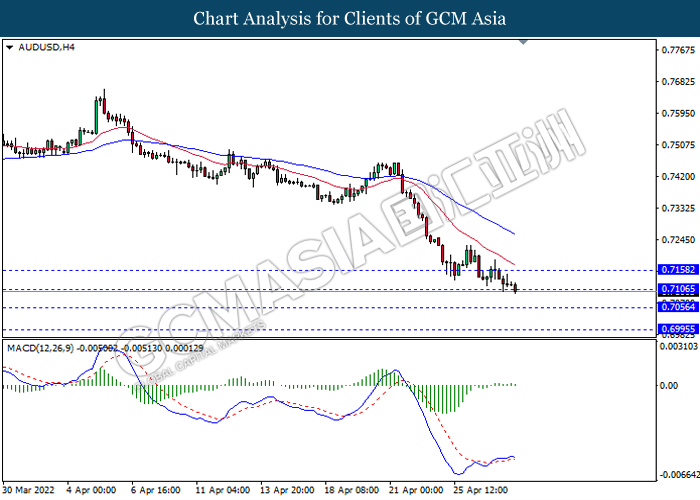

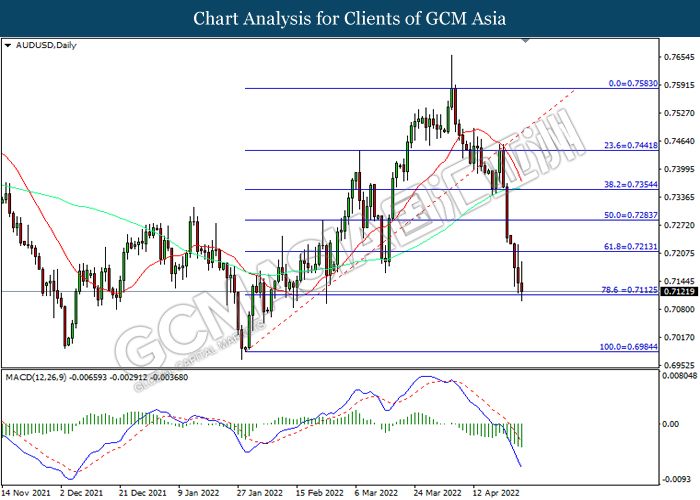

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7000, 0.7260

Support level: 0.6720, 0.6510

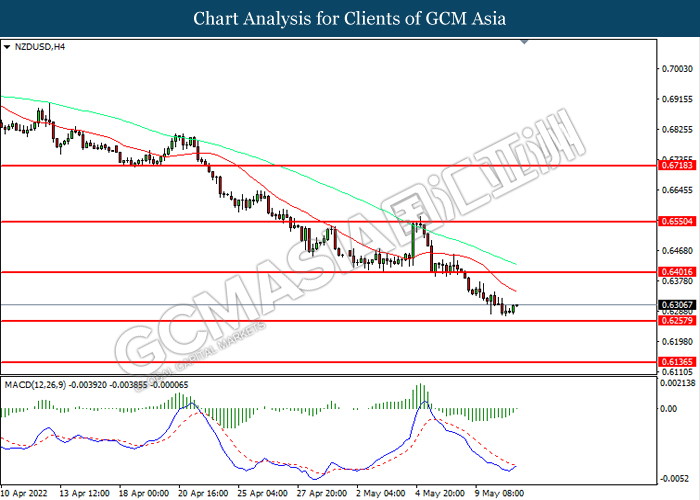

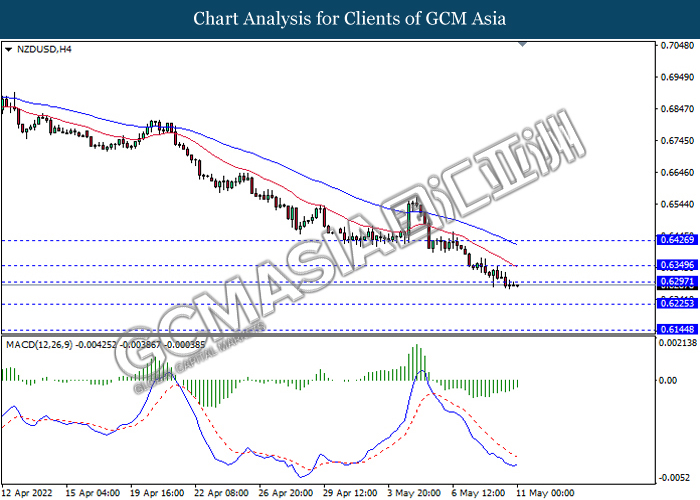

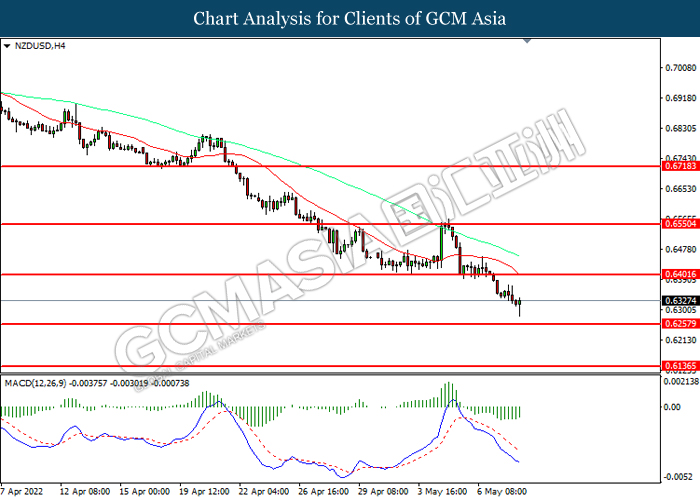

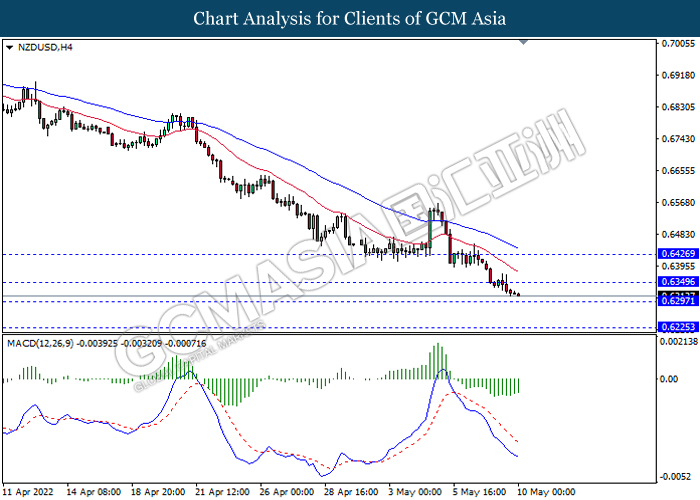

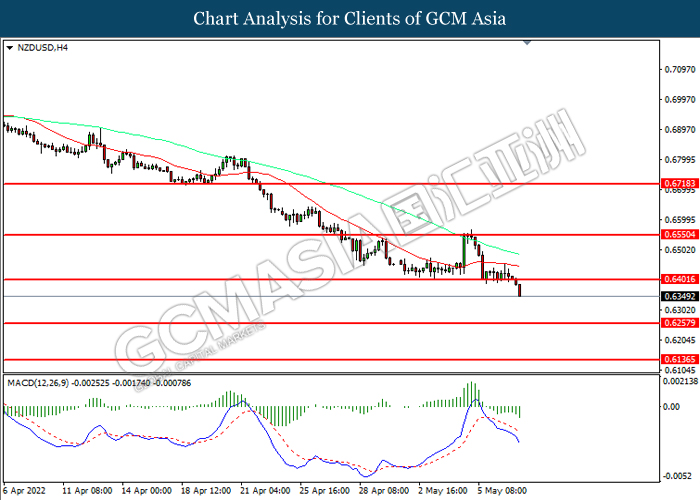

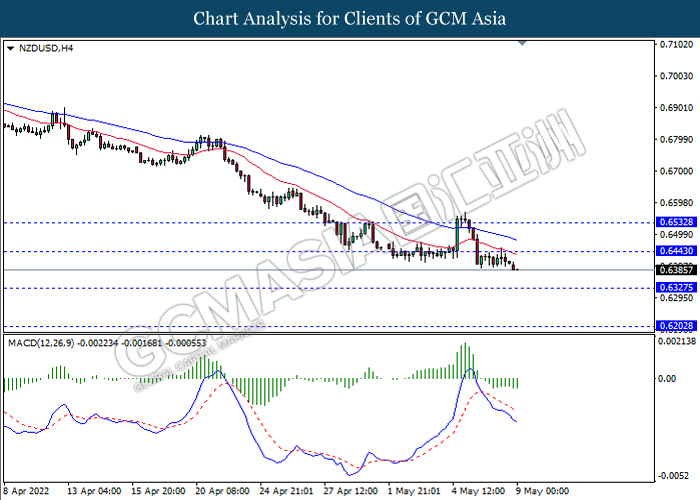

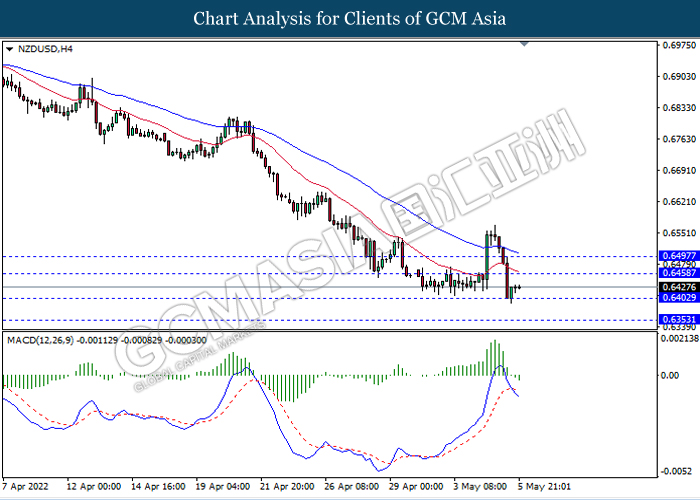

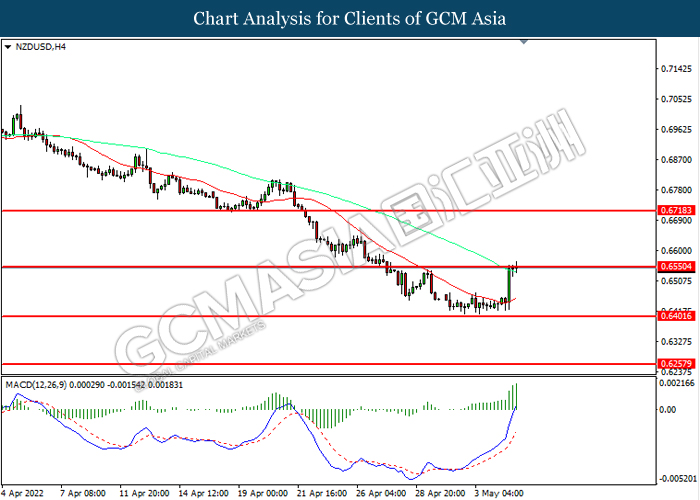

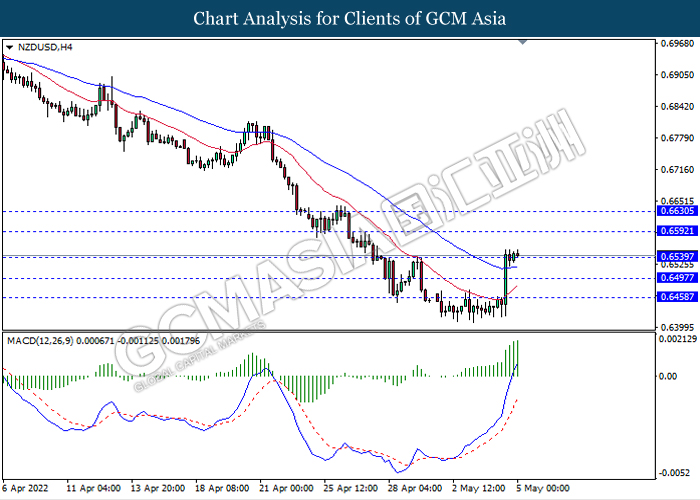

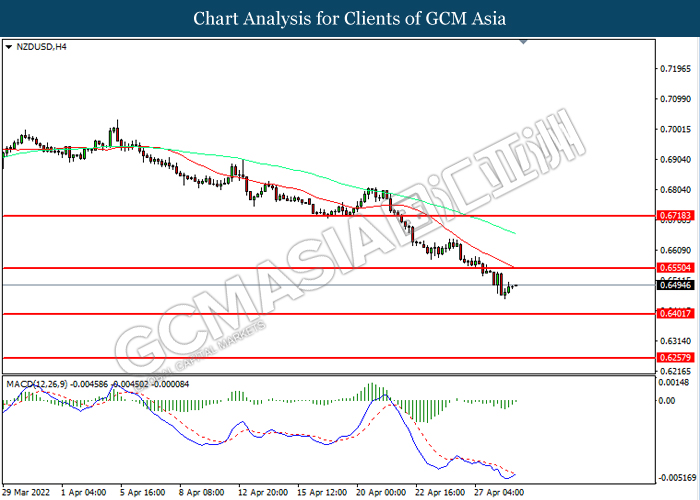

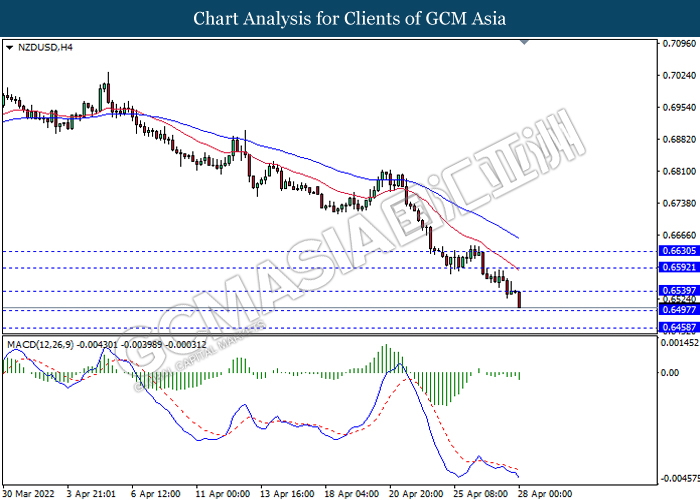

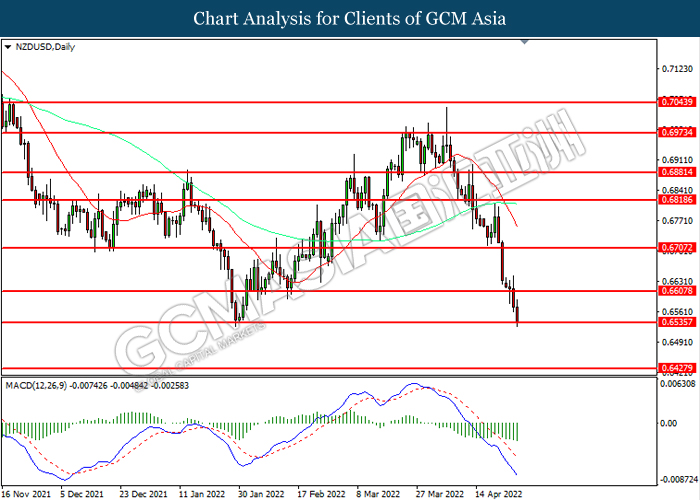

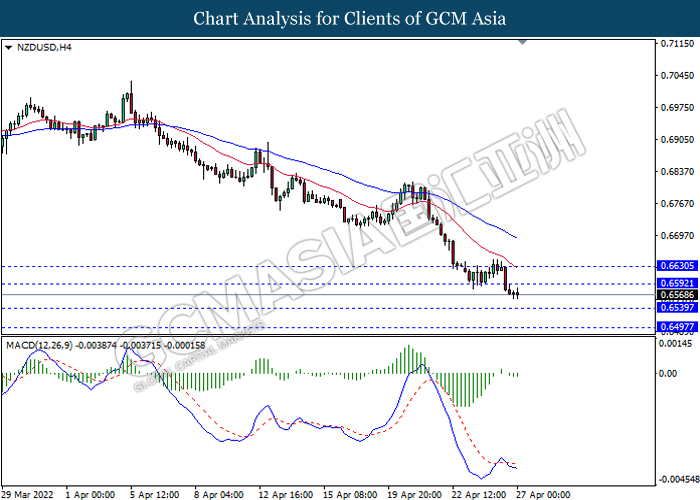

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

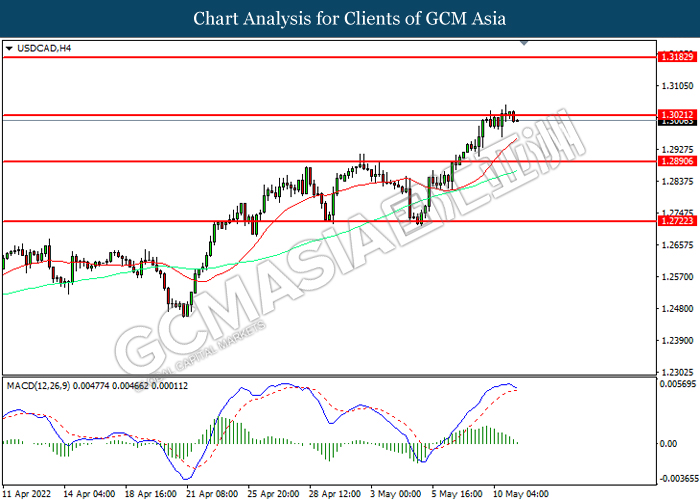

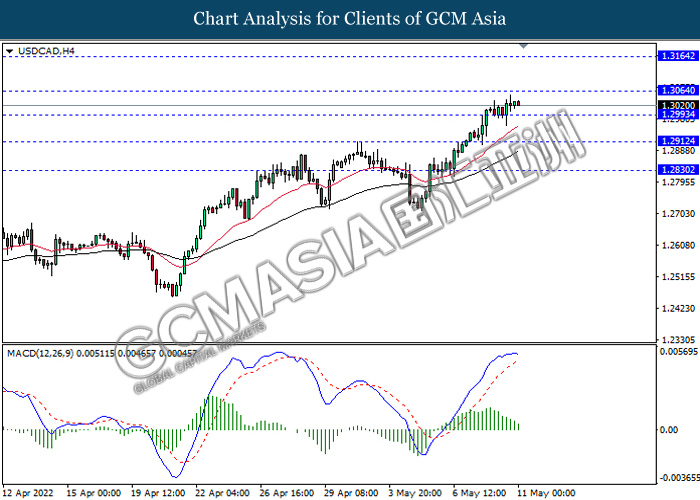

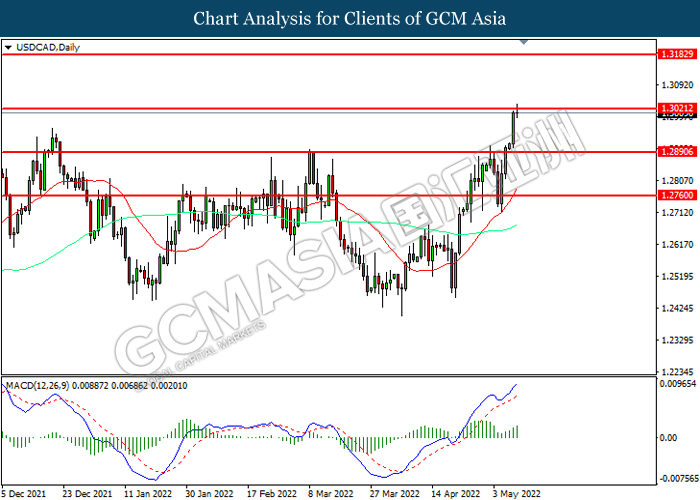

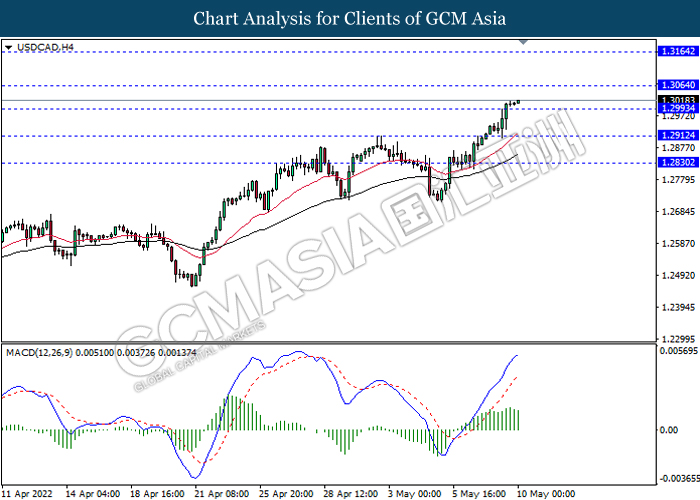

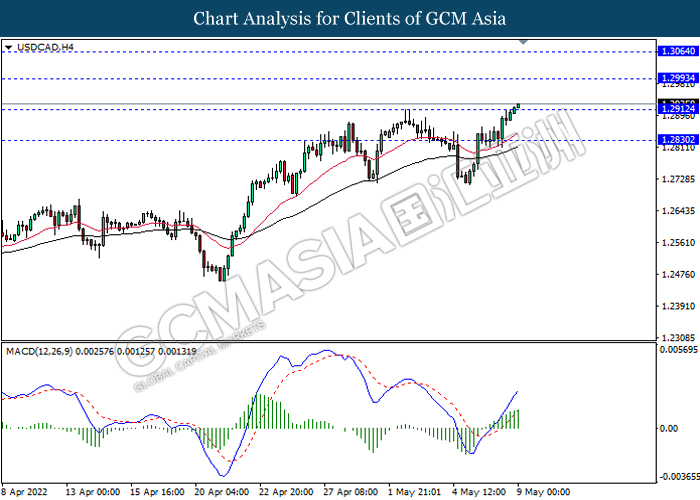

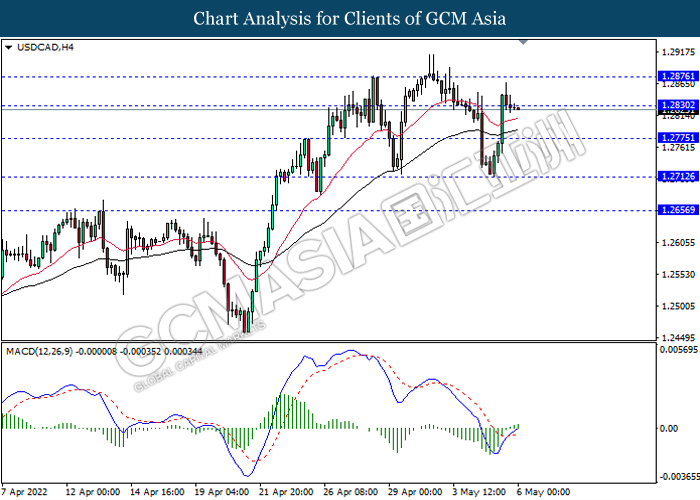

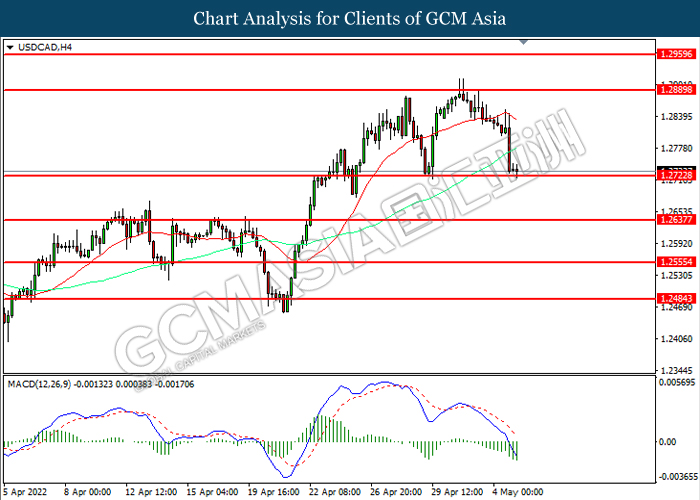

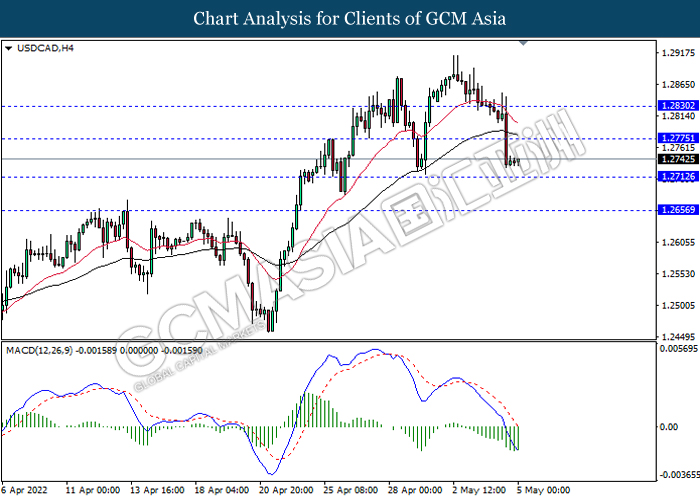

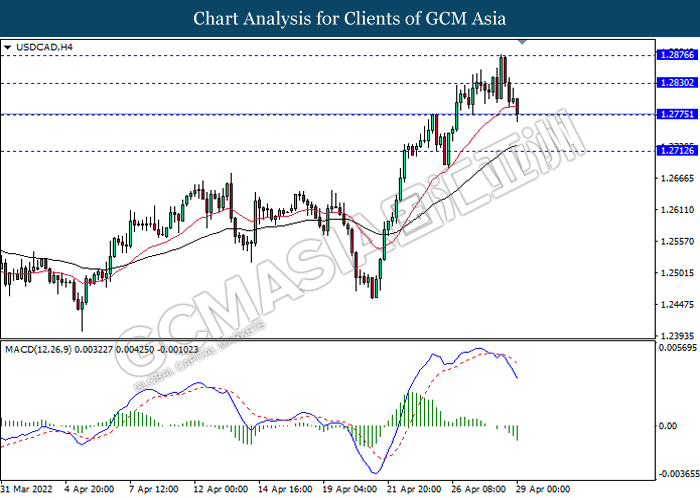

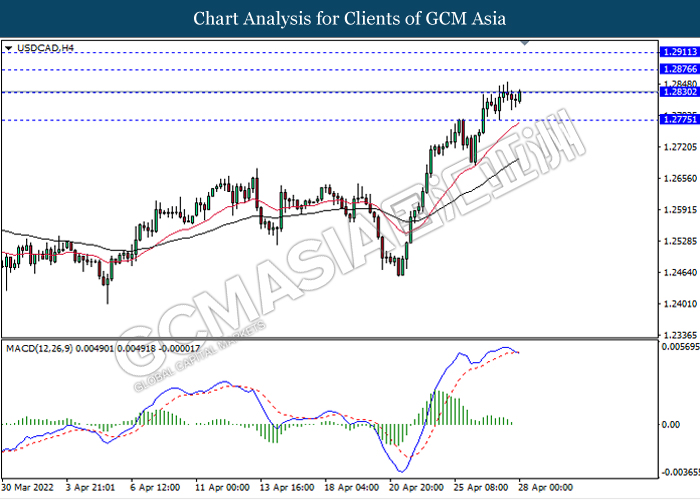

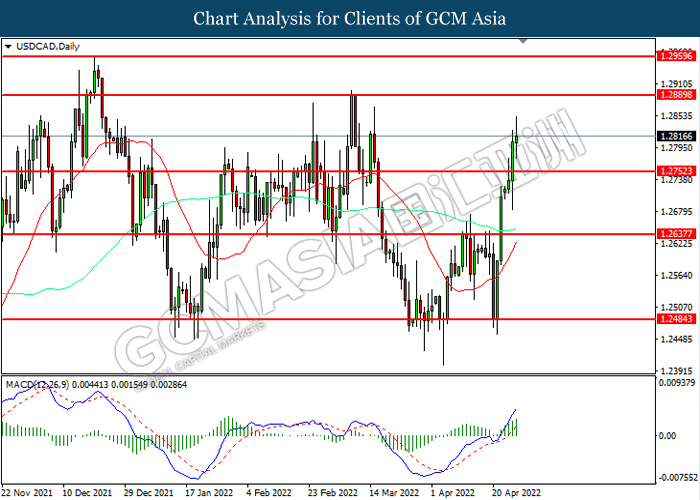

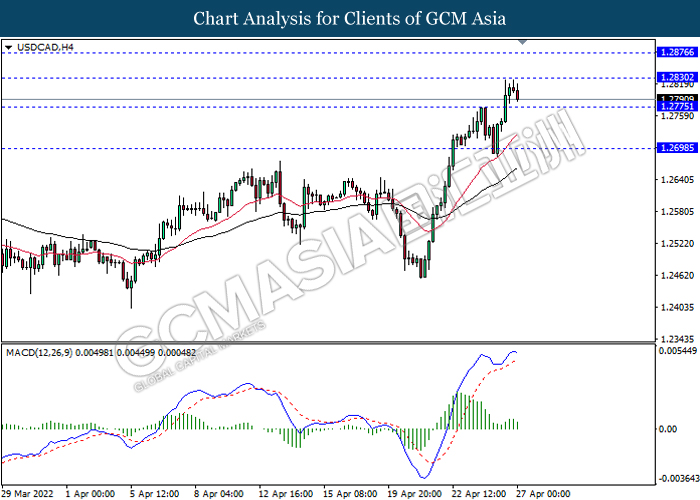

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3020. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3020, 1.3185

Support level: 1.2890, 1.2720

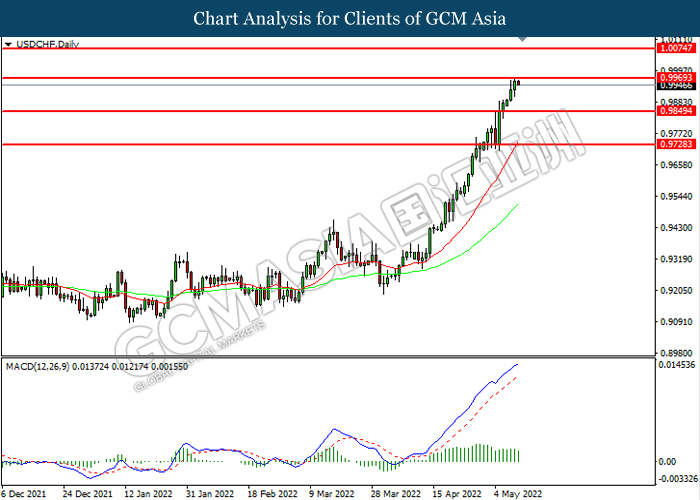

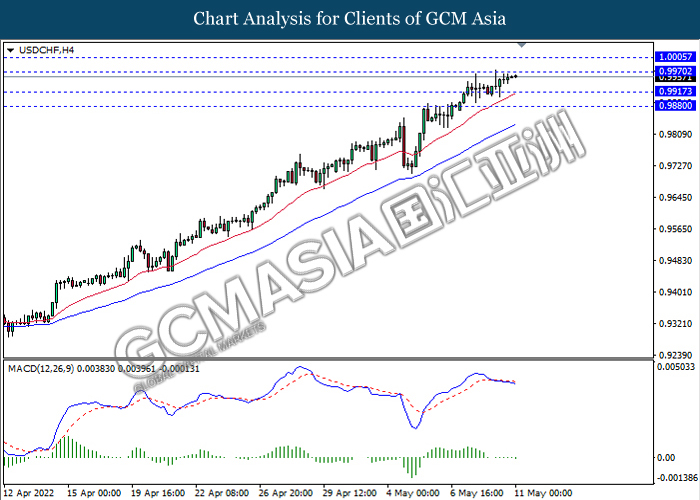

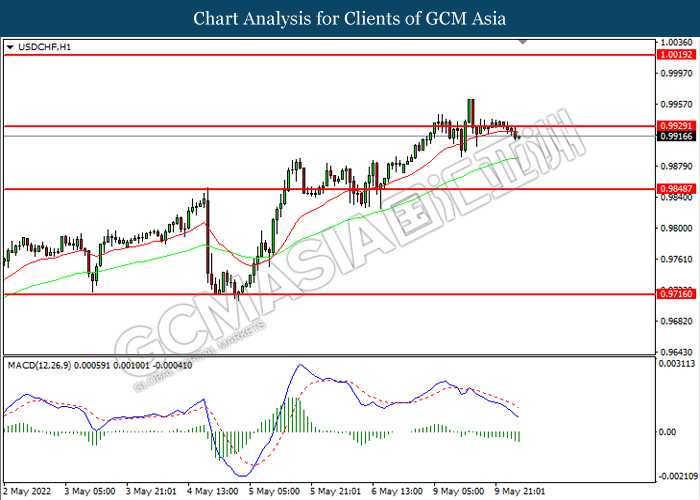

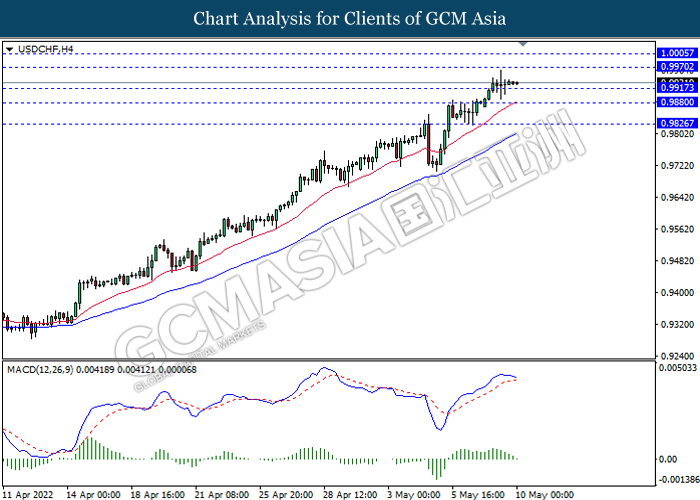

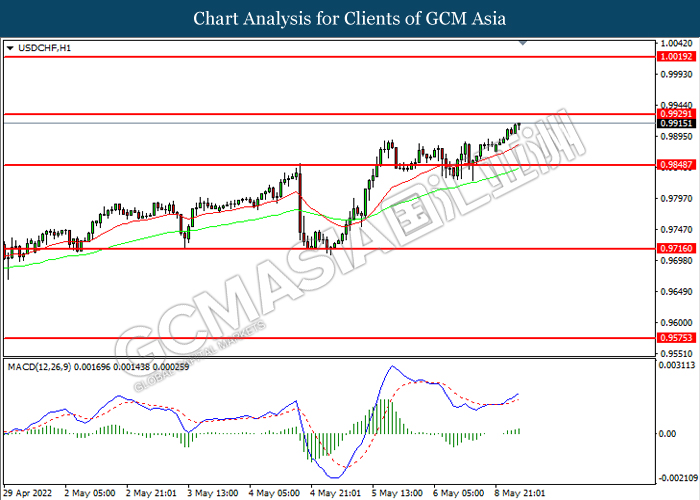

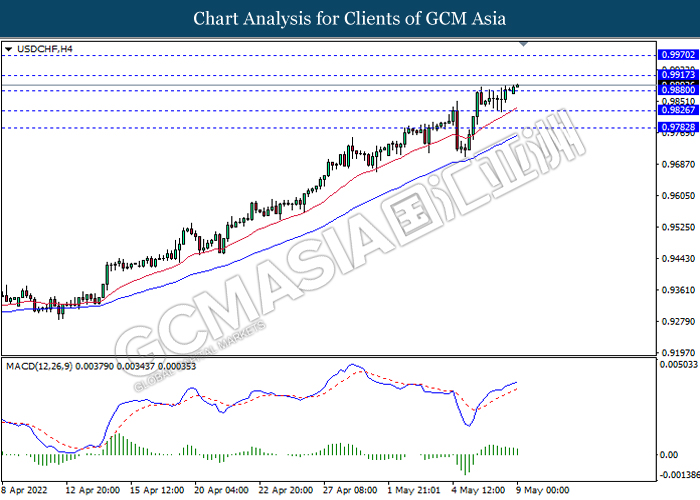

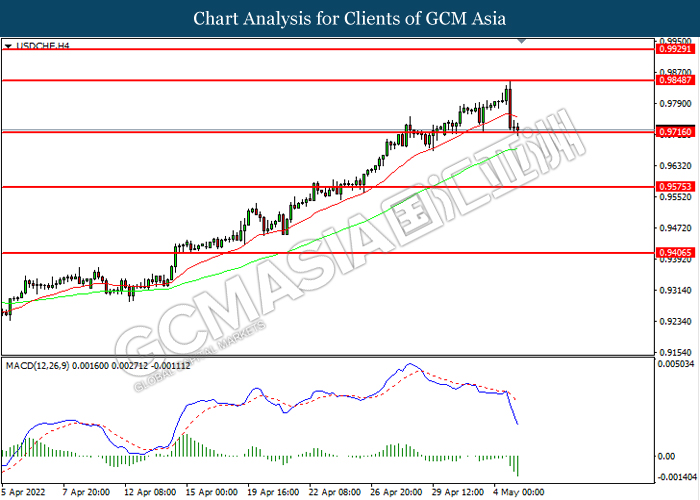

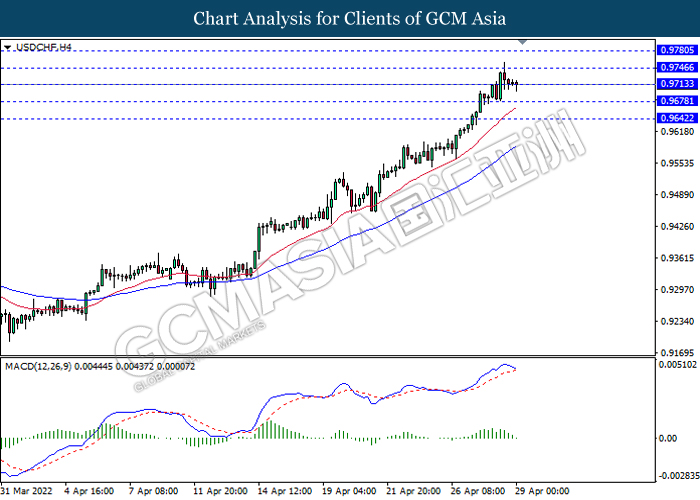

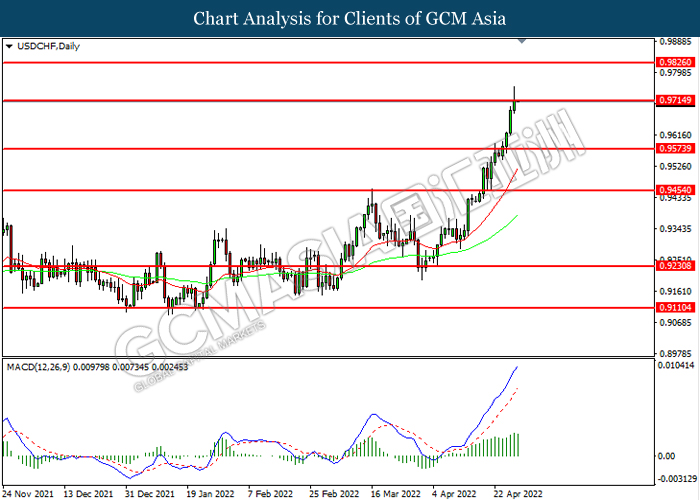

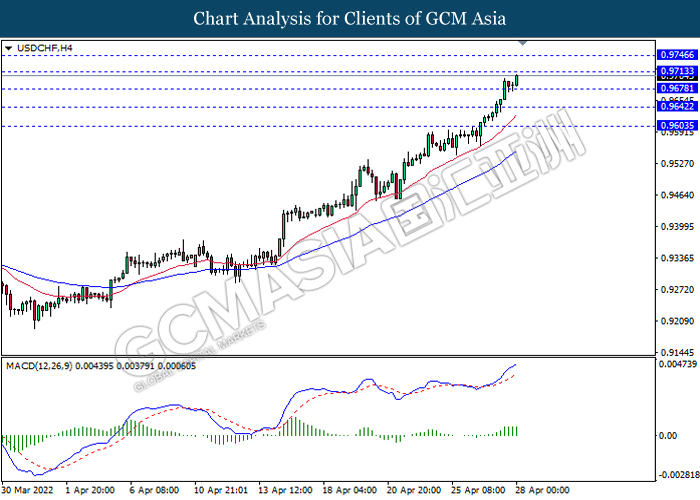

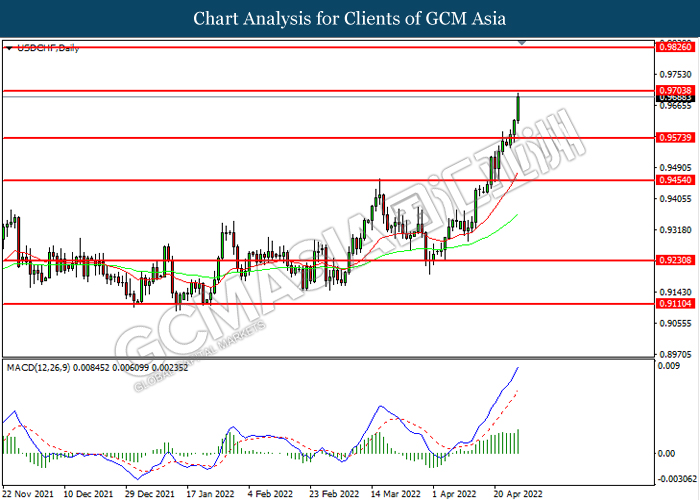

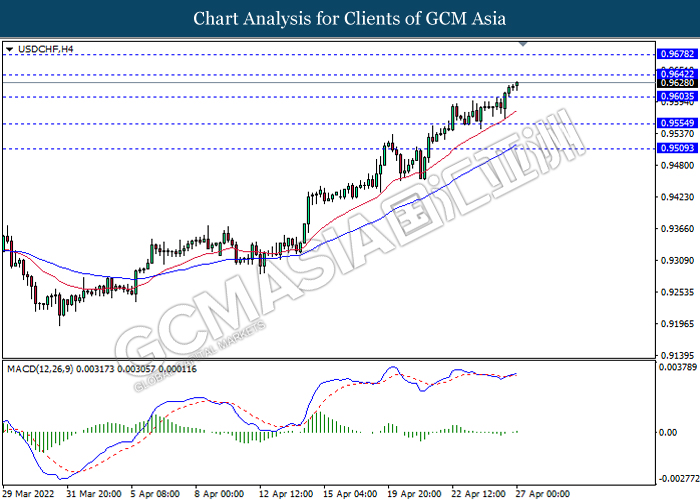

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9970, 1.0075

Support level: 0.9850, 0.9730

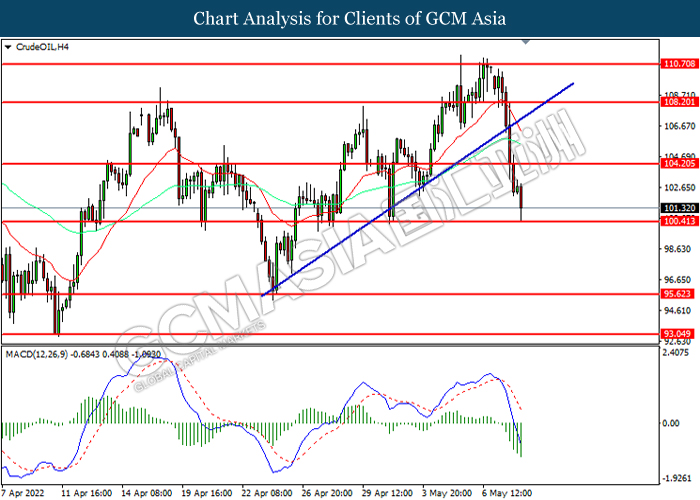

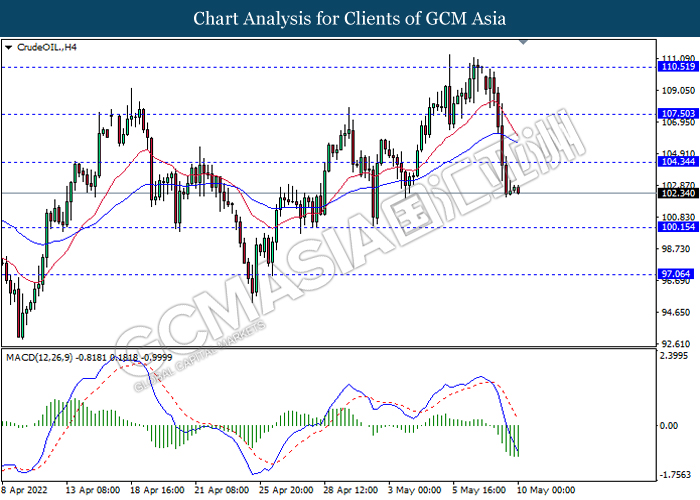

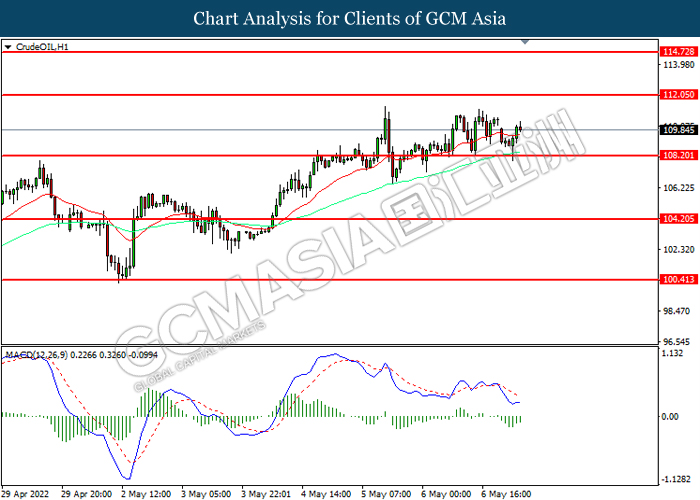

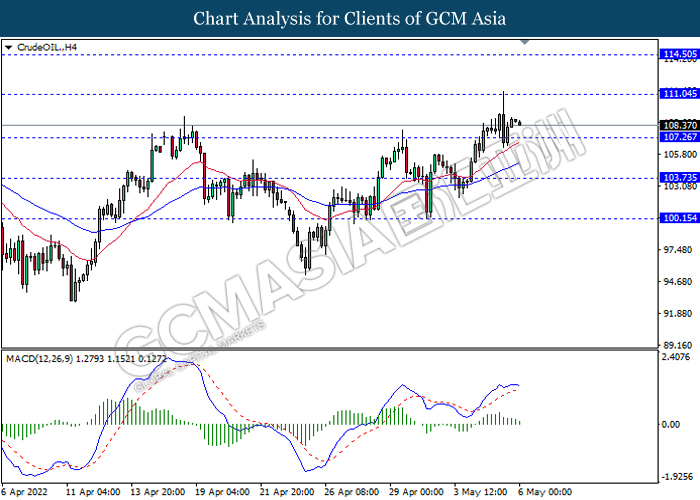

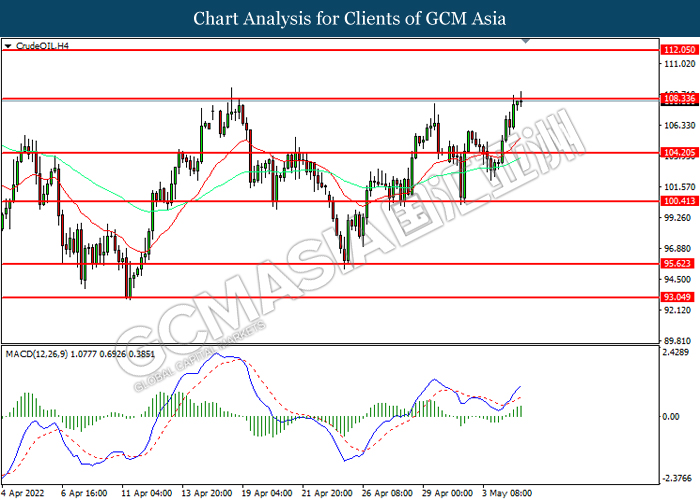

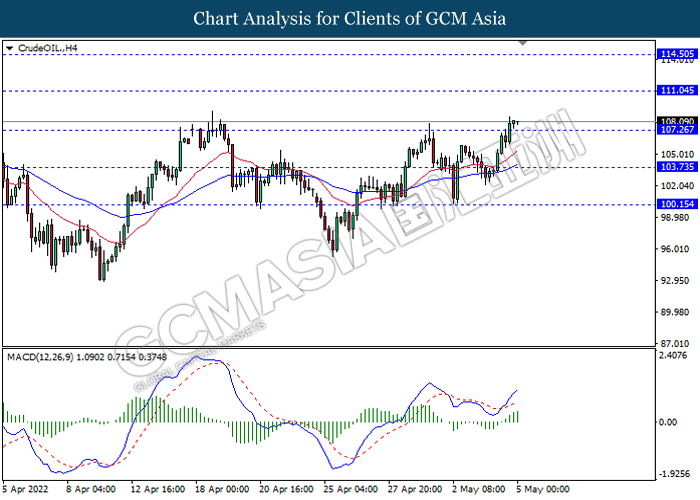

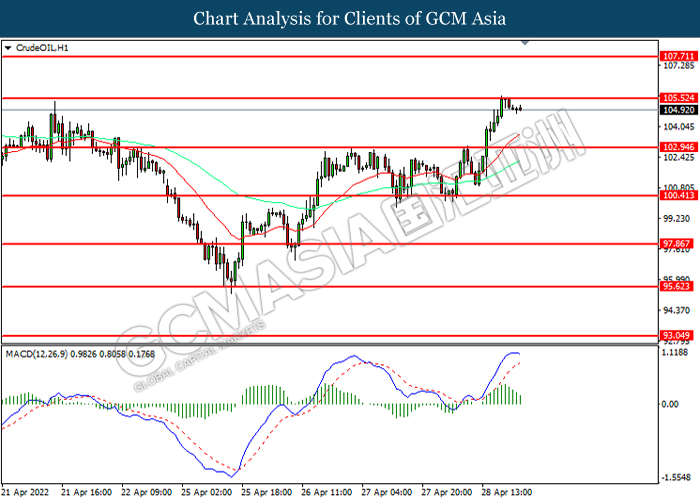

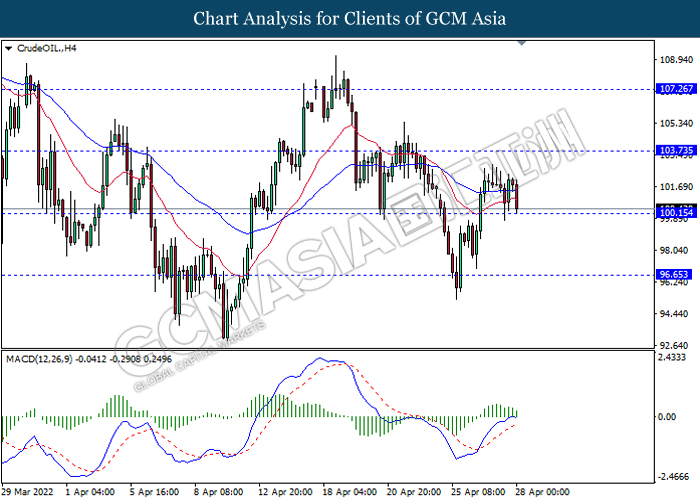

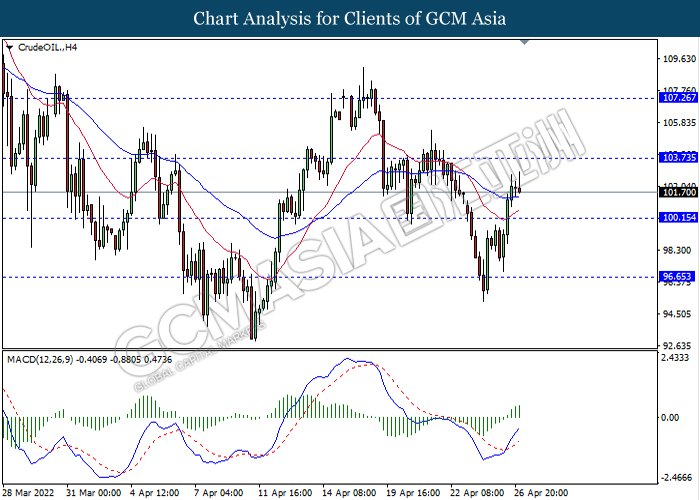

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 102.80, 104.20

Support level: 100.40, 98.15

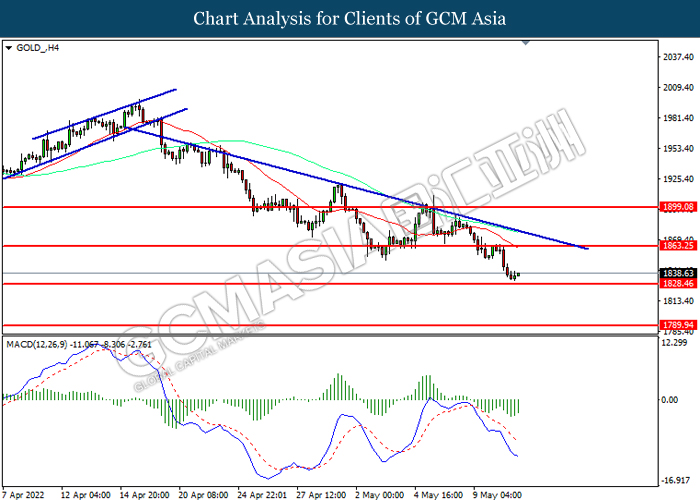

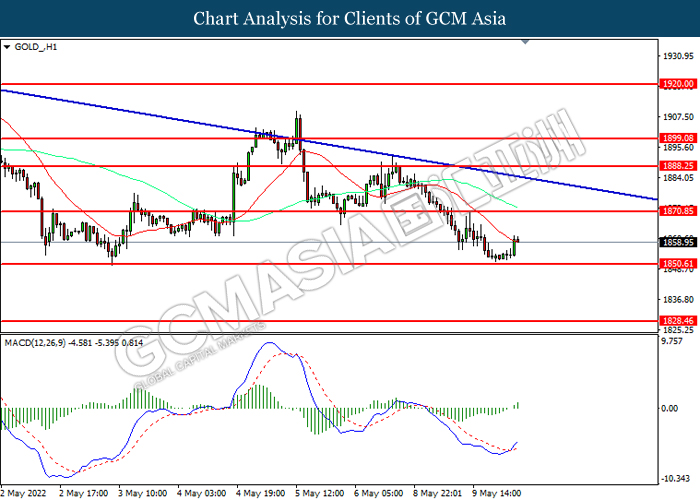

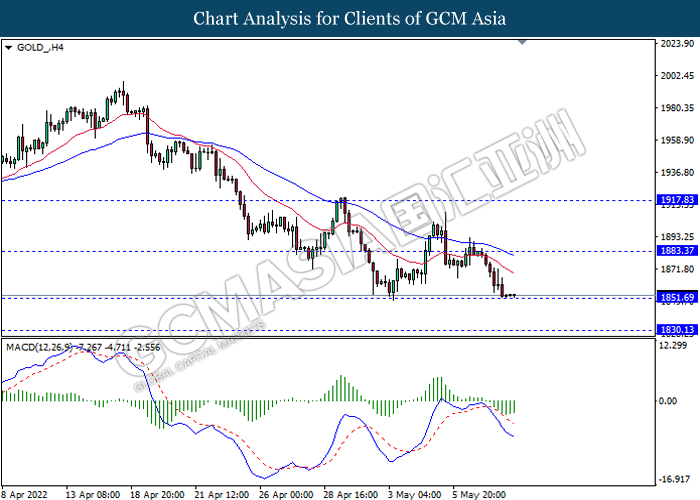

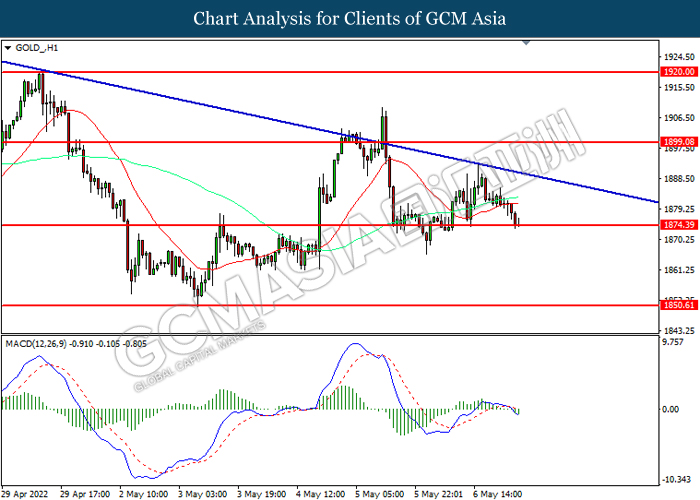

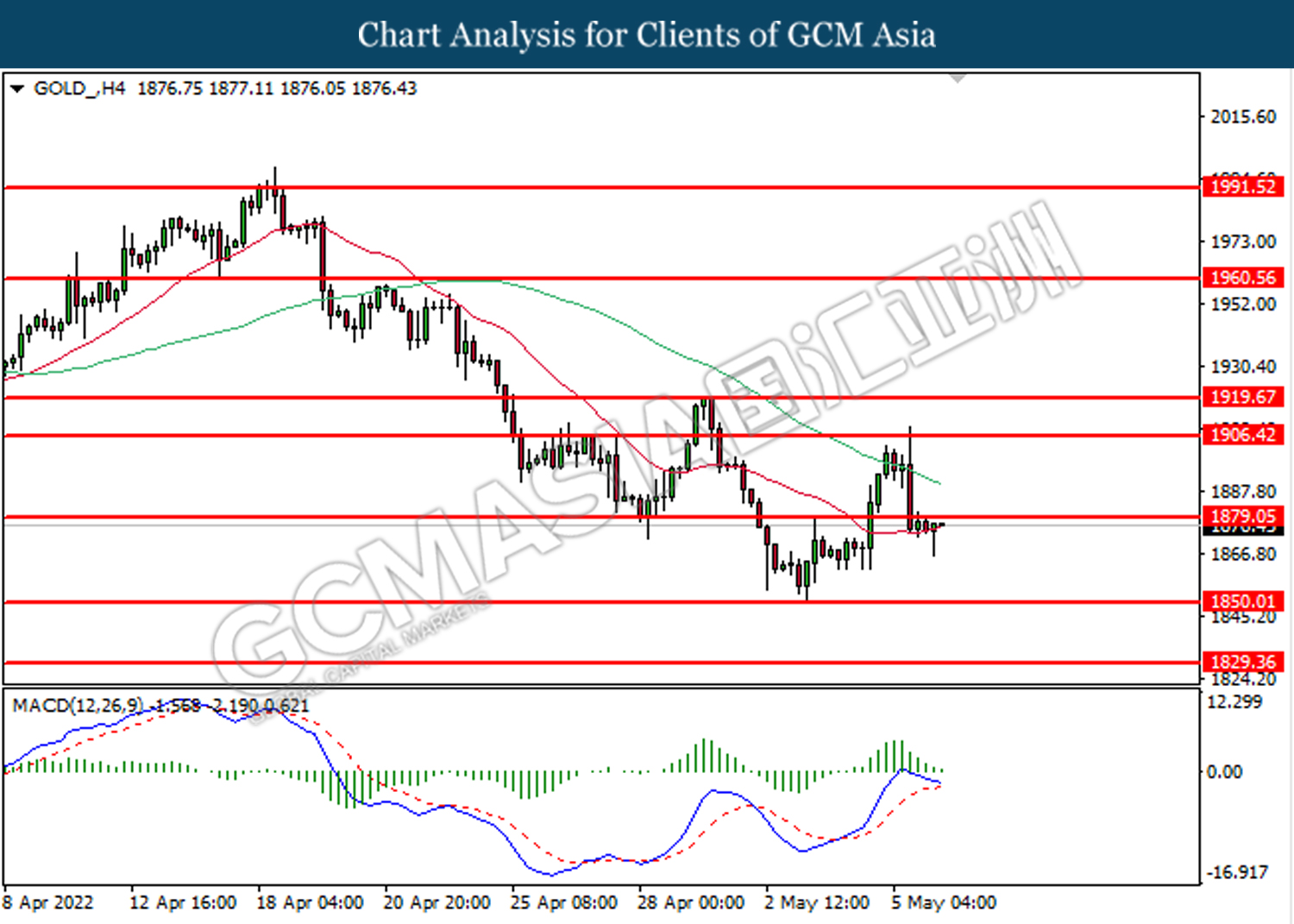

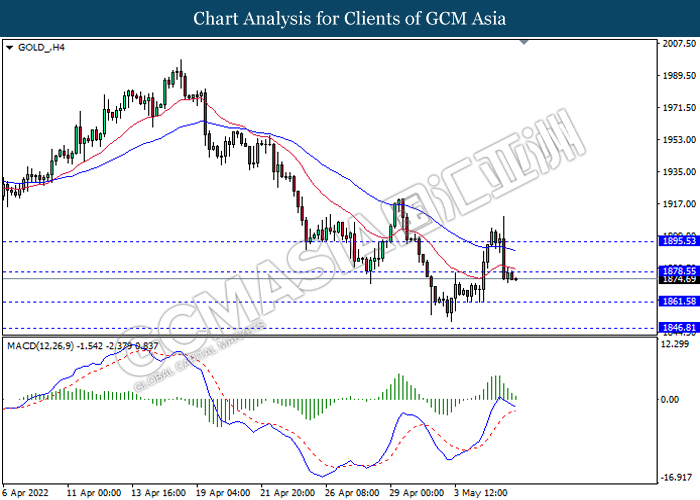

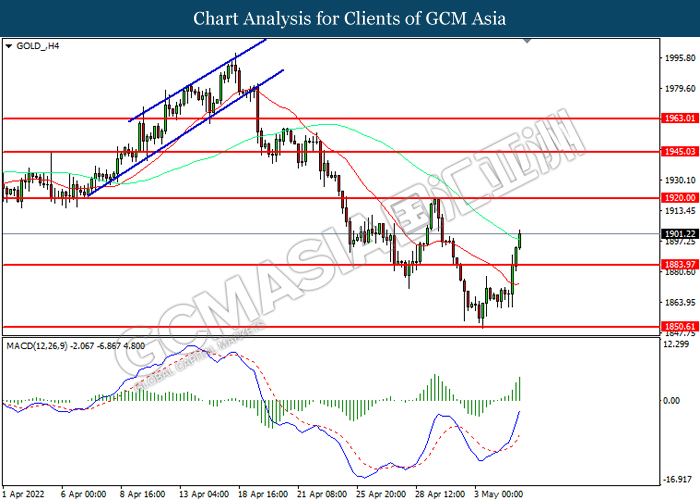

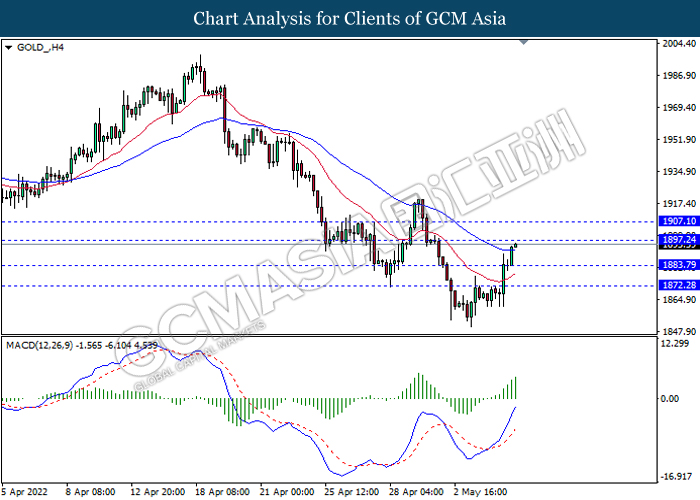

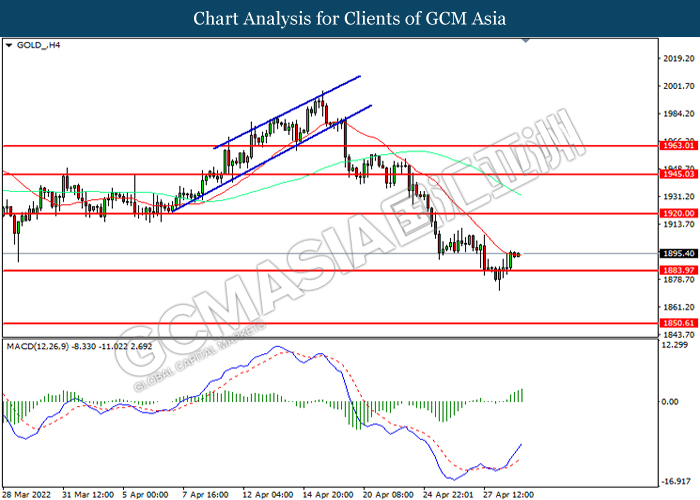

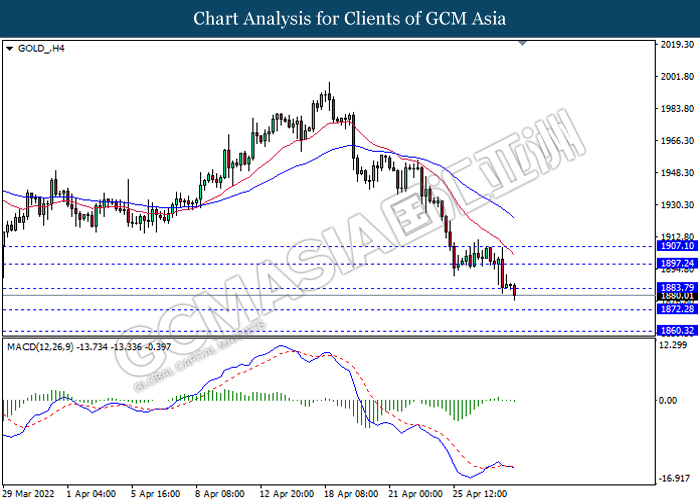

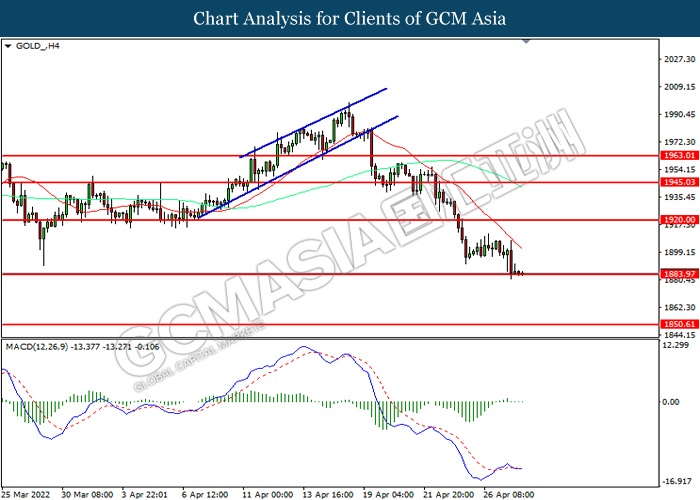

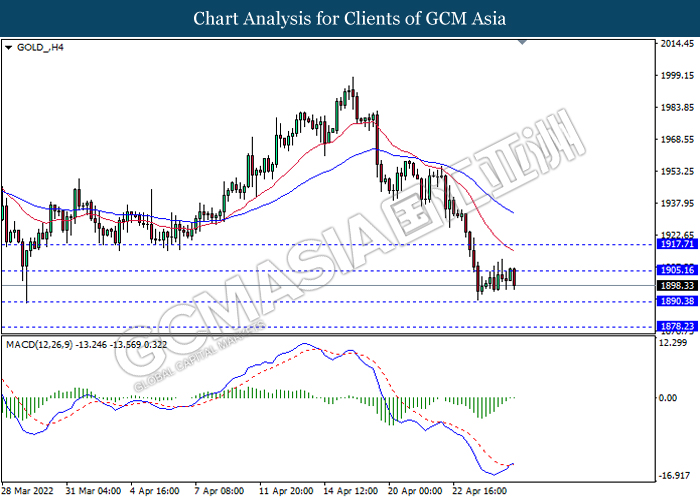

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1863.25, 1899.10

Support level: 1828.45, 1789.95

110522 Morning Session Analysis

11 May 2022 Morning Session Analysis

US Dollar surged on US inflation data expectation.

The Dollar Index which traded against a basket of six major currencies rallied on Wednesday amid the backdrop of inflation data expectation from the market. According to Reuters, investors will closely eye the April consumer price index reading on Wednesday for any signs inflation may be starting to cool, with expectations calling for a 8.1% annual increase compared to the 8.5% rise recorded in March. Nonetheless, the inflation fears continue to hover over the market, which would likely to lead Federal Reserve to imply another rate hike decision in the next FOMC meetings. The implementation of rate hike from Fed would diminish the US Dollar circulation in the market, dialed up the market optimism toward US Dollar. Besides, higher interest rate would increase investors’ risk-off return, prompting investors to shift their capitals toward safe-haven Dollar. For now, investors would continue to scrutinize the update of US Core Consumer Price Index (CPI) MoM economic data in order to gauge the likelihood movement of Dollar Index. As of writing, the Dollar Index edged up by 0.24% to 103.93.

In commodities market, crude oil price depreciated by 0.40% to $99.33 per barrel as of writing following the Covid-19 lockdowns in China, which reducing the demand of crude oil. On the other hand, gold price eased by 0.31% to $1835.30 per troy ounce as of writing over the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.3% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (Apr) | 1.2% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 1.302M | -0.829M | – |

Technical Analysis

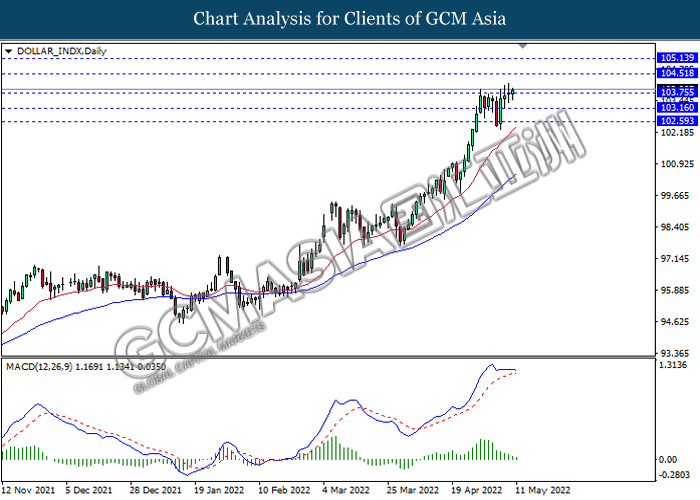

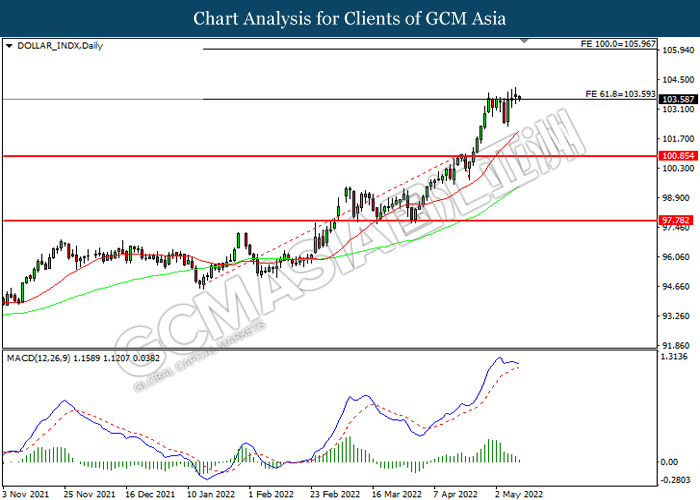

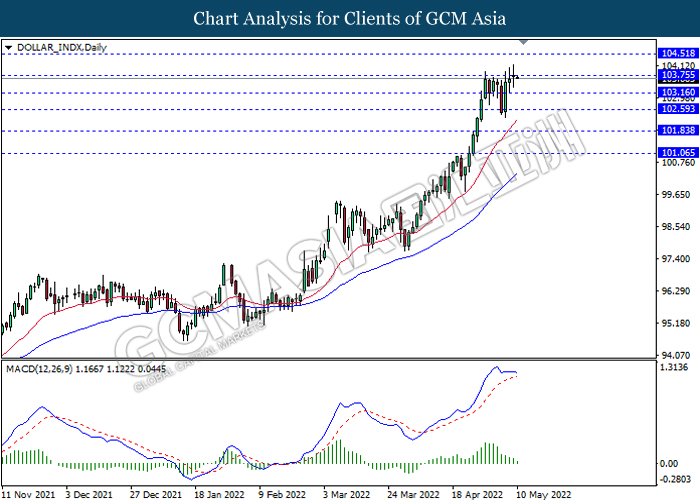

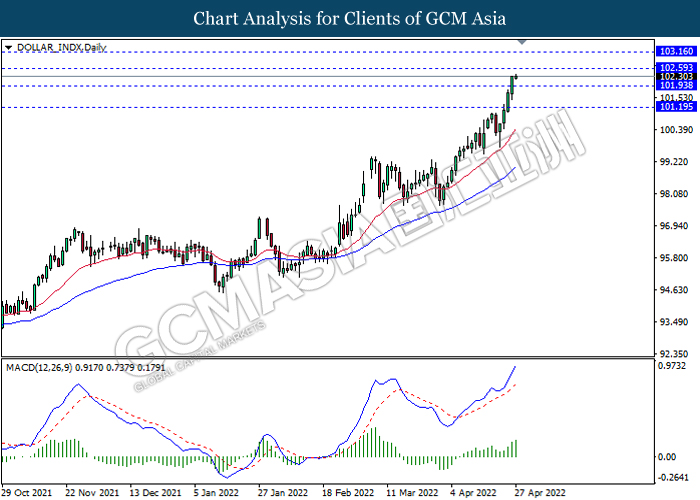

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.50, 105.15

Support level: 103.75, 103.15

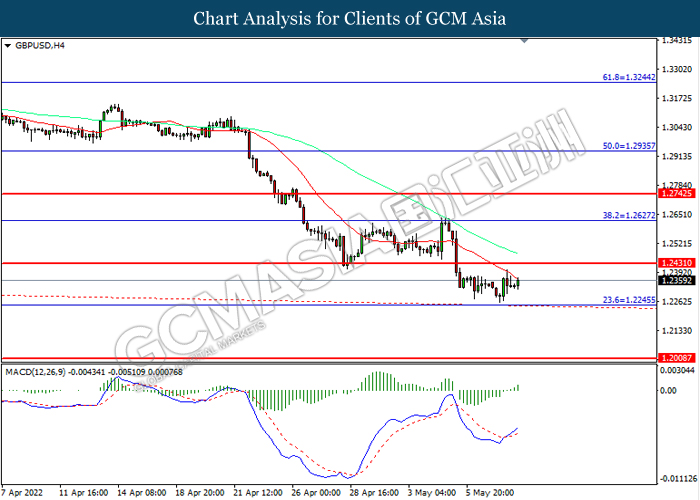

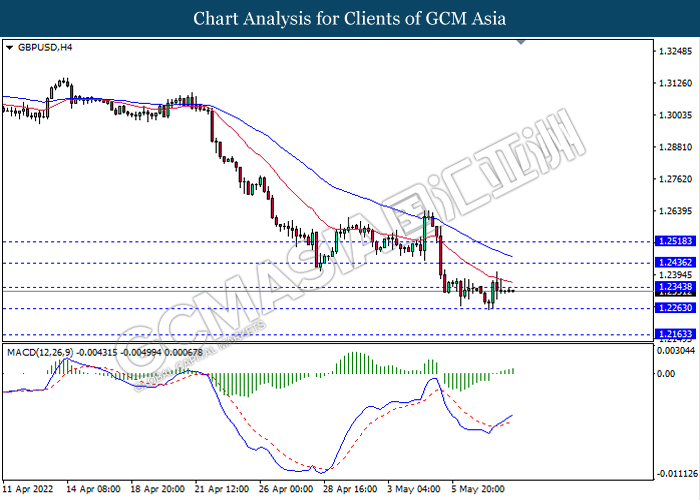

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2345, 1.2435

Support level: 1.2265, 1.2165

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

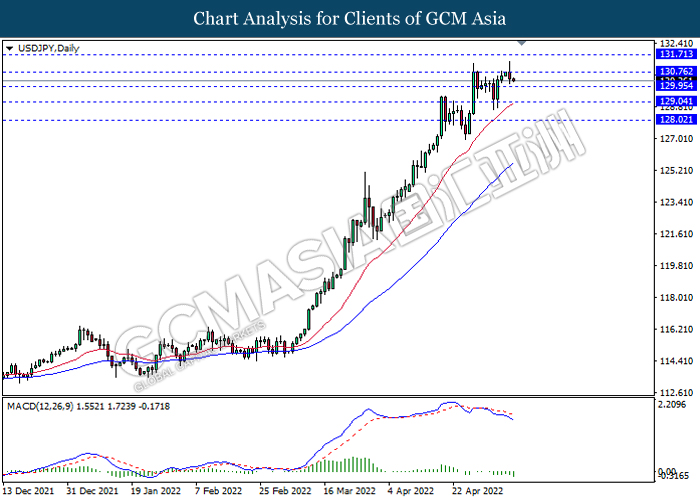

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6820

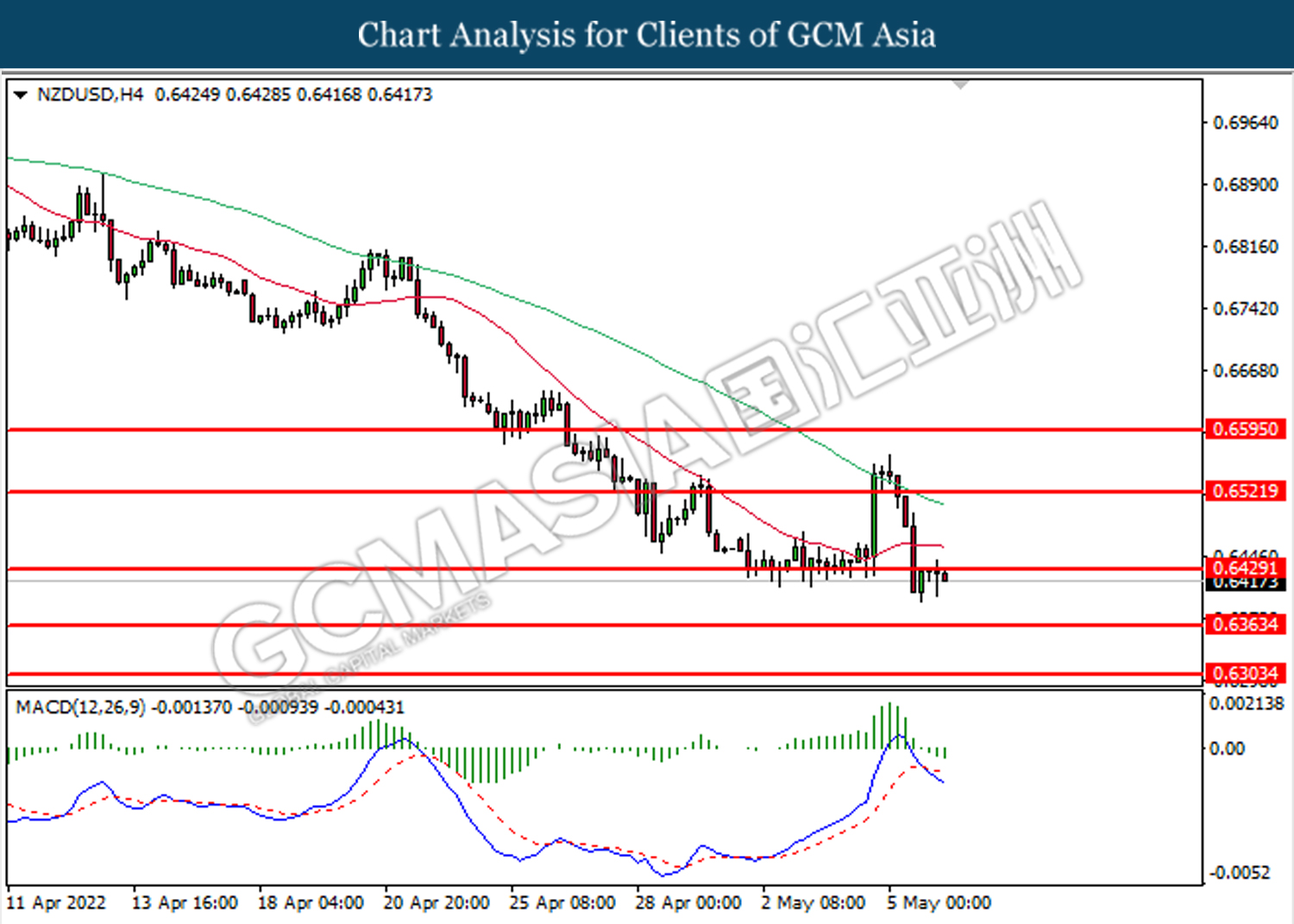

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

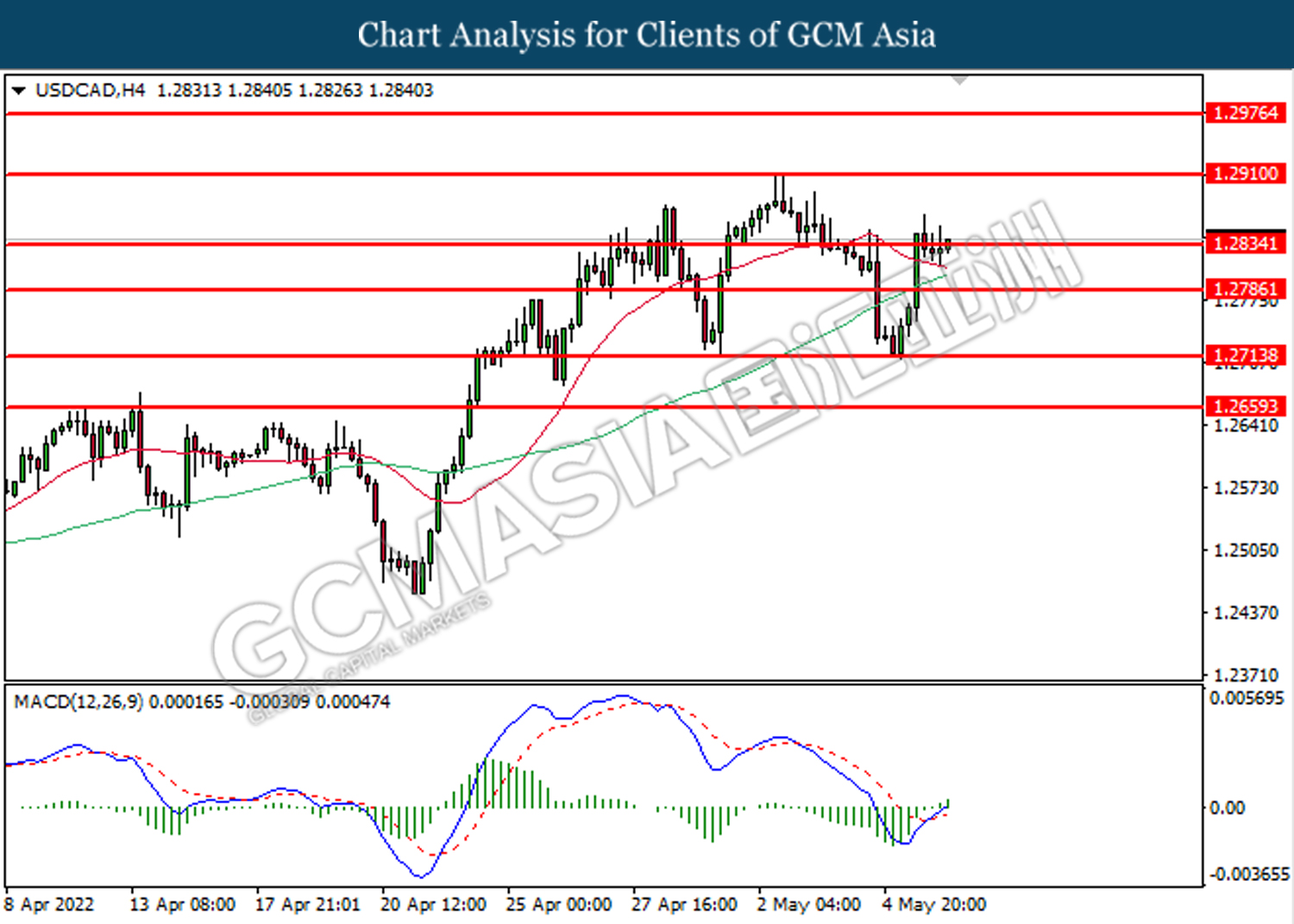

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3065, 1.3165

Support level: 1.2995, 1.2910

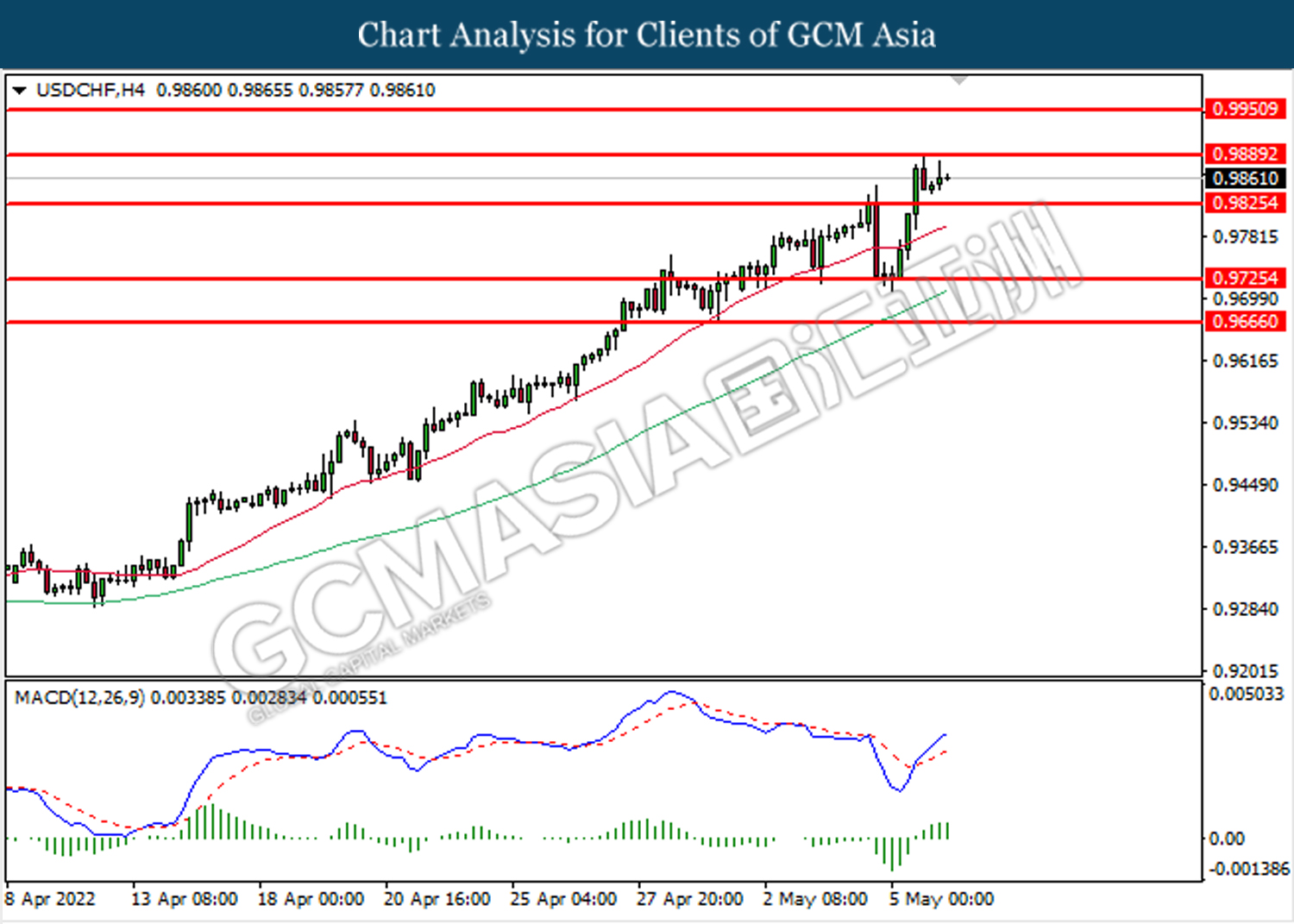

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9970, 1.0005

Support level: 0.9915, 0.9880

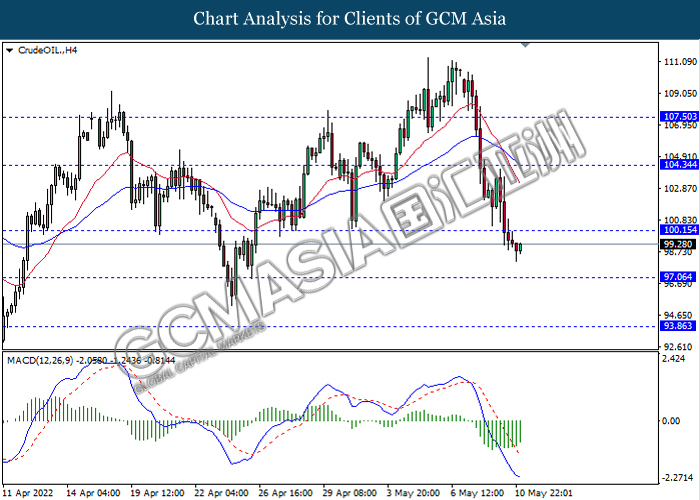

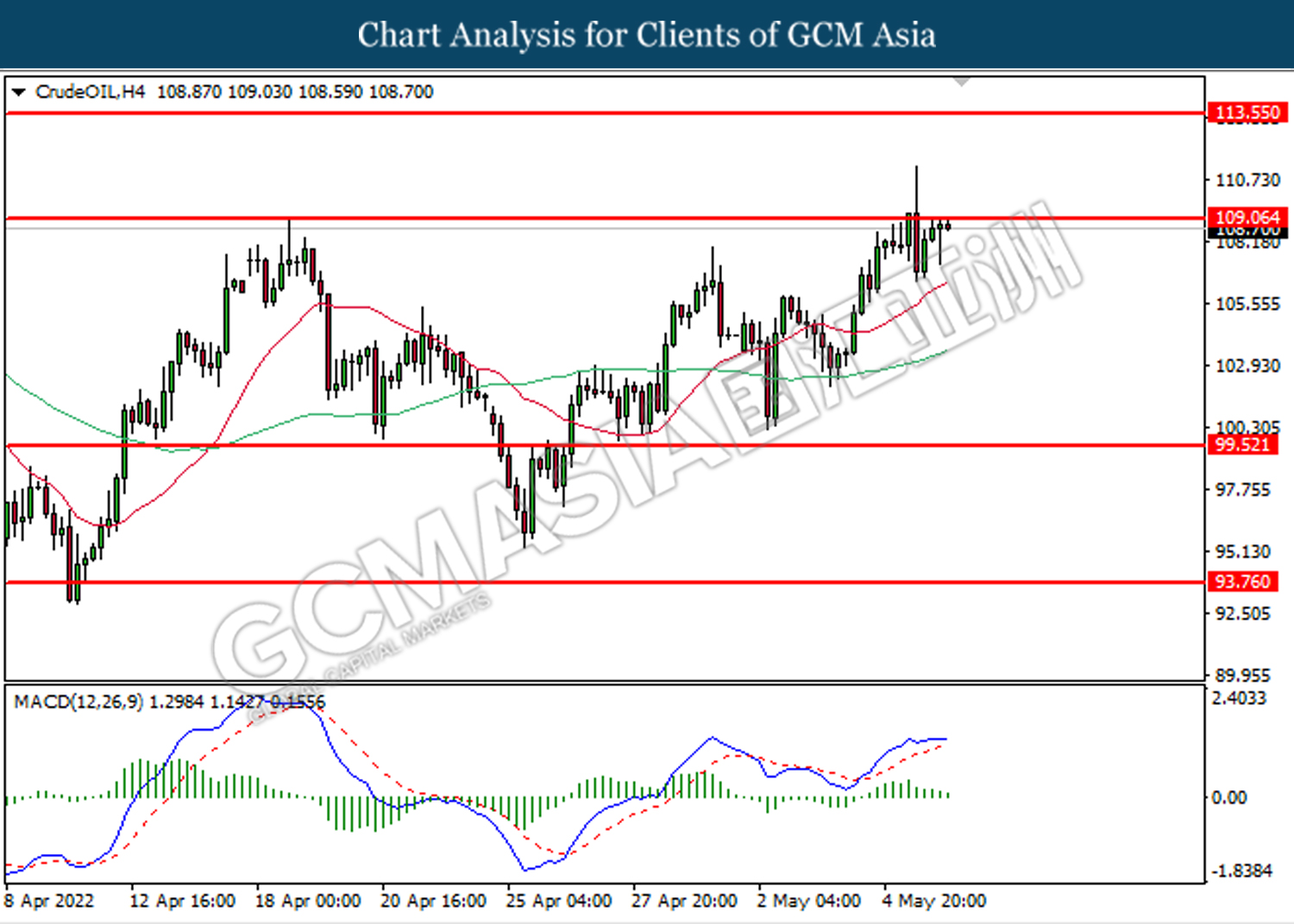

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 100.15, 104.35

Support level: 97.05, 93.85

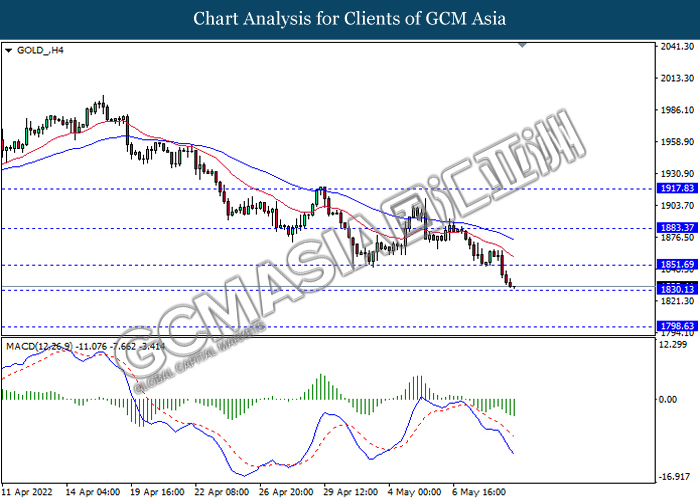

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1851.70, 1883.35

Support level: 1830.15, 1798.65

100522 Afternoon Session Analysis

10 May 2022 Afternoon Session Analysis

Aussie slumped as risk-off sentiment.

The Australia Dollar slumped significantly amid the risk-off sentiment market following the global equity market tumbled to their lowest level in nearly two years on Tuesday. The rate hike expectation from global central bank as well as stagflation risk continue lingered in the financial market. The current stagflation economic environment would lead to high inflation, high unemployment and bearish economic growth in the world. Despite the global central bank strived to implement aggressive contractionary monetary policy to combat the high inflation risk, though the current supply disruption due to the lockdown in China had insinuated further concerns for investors. The China’s export growth slowed to single digits, the weakest in almost two years as tighter and wider Covid-19 restriction halted factory production, adding further pressure on the Chinese-proxy currencies such as Australia Dollar. As of writing, the AUD/USD depreciated by 0.02% to 0.6955.

In the commodities market, the crude oil price slumped 1.08% to $101.25 per barrel as of writing. The oil market dropped drastically amid the negative economic prospect continue to weigh down the appeal for this black-commodity. On the other hand, the gold price appreciated by 0.34% to $1860.20 per troy ounces as of writing amid diminishing risk appetite in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | German ZEW Economic Sentiment (May) | -41.0 | -42.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.60. MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.60, 105.95

Support level: 100.85, 97.80

GBPUSD, H4: GBPUSD was traded higher while currently near the resistance level at 1.2430. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains after it breakout above the resistance level.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7000, 0.7260

Support level: 0.6710, 0.6510

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

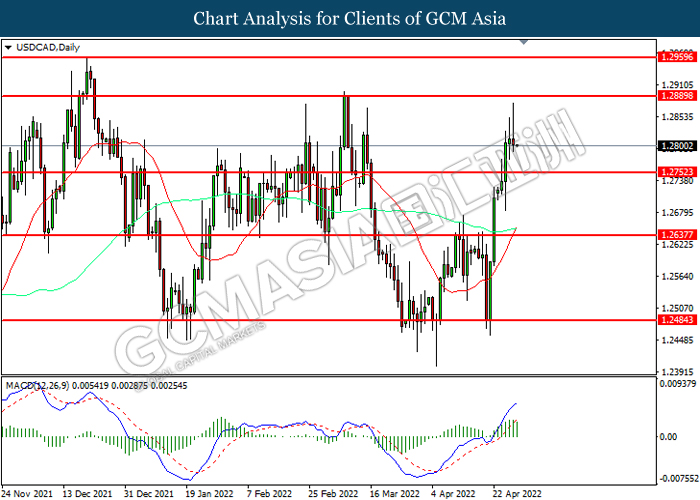

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3020. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3020, 1.3185

Support level: 1.2890, 1.2760

USDCHF, H1: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9930, 1.0020

Support level: 0.9850, 0.9715

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 104.20, 108.20

Support level: 100.40, 95.60

GOLD_, H1: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1870.85, 1888.25

Support level: 1850.60, 1828.45

100522 Morning Session Analysis

10 May 2022 Morning Session Analysis

US Dollar rose following market inflation concerns.

The Dollar Index which traded against a basket of six major currencies edged up on Tuesday over the concern for inflation risk from the market. Russia invasion of Ukraine had led to the disruption of global supply chain, causing the commodities price such as crude oil to soar. The war-driven inflation had brought negatives prospects toward global economic growth, which dialed up the market optimism toward the risk-averse assets such as US Dollar. Besides, Federal Reserve Chairman Jerome Powell had claimed that the US central bank will act aggressively to stamp out inflation. He reiterated that the additional 50 basis point rate hike should be on the table for the next couple of meetings, which sparkling the appeal for the US Dollar. Nonetheless, the gains experiences by Dollar Index was limited following the ease of US 10-Year Treasury yields. According to Reuters, yields on most US Treasury notes pared early gains to trade lower on Monday as bargain-hunters stepped in after the benchmark 10-year yield hit fresh three and the half year highs of 3.203% as inflation fears continued to roil markets. As of writing, the Dollar Index appreciated by 0.08% to 103.77.

In commodities market, crude oil price depreciated by 0.38% to $102.70 per barrel as of writing amid the backdrop of rising Covid-19 cases in China, which diminishing the demand for crude oil. On the other hand, gold price depreciated by 0.28% to $1853.32 per troy ounce as of writing over the rallies of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | German ZEW Economic Sentiment (May) | -41.0 | -42.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.60

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2345, 1.2435

Support level: 1.2265, 1.2165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6820

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6225

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3065, 1.3165

Support level: 1.2995, 1.2910

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9970, 1.0005

Support level: 0.9915, 0.9880

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 104.35, 107.50

Support level: 100.15, 97.05

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1883.35, 1917.85

Support level: 1851.70, 1830.15

090522 Afternoon Session Analysis

9 May 2022 Afternoon Session Analysis

CAD slumped as bearish data.

The Canada Dollar slumped over the backdrop of a string of bearish economic data last week, which dialing down the market optimism toward the economic progression in Canada. According to Statistic Canada, the Canada Employment Change notched down significantly from the previous reading of 72.5K to 15.3K, missing the market forecast at 55.0K. The employment Change is a measure of the change in the number of employed people in Canada. Generally speaking, a drop in this indicator has negative implications for consumer spending which spurring negative prospect toward the economic momentum. Besides, Canada claimed that they would continue to provide Ukraine with all kinds of humanitarian and financial assistance. This year’s state budget of Canada provides another 4 1 billion for a loan to Ukraine through the IMF mechanism. Currently, the tensions between Ukraine-Russia intensified, spurring further concerns the impact of the Russian invasion toward the Canada’s economy. As of writing, USD/CAD increased by 0.24% to 1.2937.

In the commodities market, the crude oil price depreciated by 0.60% to $110.45 per barrel. The oil market slumped amid the fears upon the global recession could dampen oil demand, though investors are currently eying EU talks on the implementation of sanction upon Russia to receive further trading signal. On the other hand, the gold price depreciated by 0.40% to $1876.15 per troy ounces as of writing amid rate hike expectation from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Weekly: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 105.95, 109.80

Support level: 103.60, 100.85

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout below the support level.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 0.7260, 0.7510

Support level: 0.7000, 0.6720

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2960. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2960, 1.3060

Support level: 1.2865, 1.2735

USDCHF, H1: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9930, 1.0020

Support level: 0.9850, 0.9715

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 112.05.

Resistance level: 112.05, 114.75

Support level: 108.20, 104.20

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1899.10, 1920.00

Support level: 1874.40, 1850.60

090522 Morning Session Analysis

9 May 2022 Morning Session Analysis

US Dollar rallied on upbeat economic data.

The Dollar Index which traded against a basket of six major currencies edged up on Monday over the upbeat economic data. According to Bureau of Labor Statistics, US Nonfarm Payrolls recorded at the reading of 428K, exceeding the market forecast of 391K. Nonfarm Payrolls measures the change in the number of people employed during the previous month, which excluding the farming industry. The higher than expected reading indicates that there are more people are employed in US, which brought positive prospects toward economic progression in US. Besides, according to Reuters, the long-dated US Treasury yields surged and global stock markets slid further on Friday following the inflation concerns. The war-driven inflation would likely to lead Federal Reserve to imply another aggressive rate hike in the next FOMC meetings, prompting investors to shift their capitals toward safe-haven Dollar. Nonetheless, the gains of Dollar Index was limited amid the rise of US Unemployment Rate. The US Unemployment Rate came in at the reading of 3.6%, which exceeding the market forecast of 3.5%, according to Bureau of Labor Statistics. The higher unemployment rate would likely to drag down the economic development in US, which beat down the appeal for the US Dollar. As of writing, the Dollar Index appreciated by 0.10% to 103.80.

In commodities market, crude oil price depreciated by 0.70% to $107.00 per barrel as of writing over the backdrop of Saudi Arabia lowered the price of its Arab Light crude grade to Asia and Europe for the month of June. On the other hand, gold price eased by 0.14% to $1880.08 per troy ounces as of writing on the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.60

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2345, 1.2435

Support level: 1.2265, 1.2165

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains if successfully breakout the resistance level.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7075, 0.7160

Support level: 0.6995, 0.6925

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6445, 0.6530

Support level: 0.6325, 0.6200

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2995, 1.3065

Support level: 1.2910, 1.2830

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9915, 0.9970

Support level: 0.9880, 0.9825

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 110.50, 112.95

Support level: 107.50, 104.35

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1917.85, 1958.25

Support level: 1866.25, 1830.15

060522 Afternoon Session Analysis

6 May 2022 Afternoon Session Analysis

Pound dived following the sharp drop in UK bond yield

The Pound Sterling received significant bearish momentum as the UK government bond yields fell sharply despite the Bank of England increased their interest rate by 1%, lifting the cost of borrowing to the highest level in 13 years. Nonetheless, the BoE warned the UK economy was at risk of recession, sparkling further concerns for stagflation in future. Annual UK inflation hit a 30-year high of 7% in March, exceeding the BoE target level as food and energy prices continue to surged significantly. UK Consumer confidence, meanwhile plunged to a near record low in April amid negative prospect for economic growth. Currently, the BoE expects UK inflation to rise to roughly 10% this year as a result of Russia-Ukraine war and lockdowns in China, which spurring further concerns on supply disruption. Nonetheless, investors would continue to scrutinize further updates with regards of crucial economic data to receive further trading signal. As of writing, the pair of GBP/USD rebounded by 0.08% to 1.2375.

In commodities market, the crude oil price rose by 0.21% to $109.25 per barrel as the market worried about the balance between the supply and demand of oil following the EU laid out the sanction against Russia. On the other hand, gold price down by 0.01% to $1876.95 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 59.1 | 58 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 431K | 391K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.60% | 3.50% | – |

| 20:30 | CAD – Employment Change (Apr) | 72.5K | 55.0K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 74.2 | 60 | – |

Technical Analysis

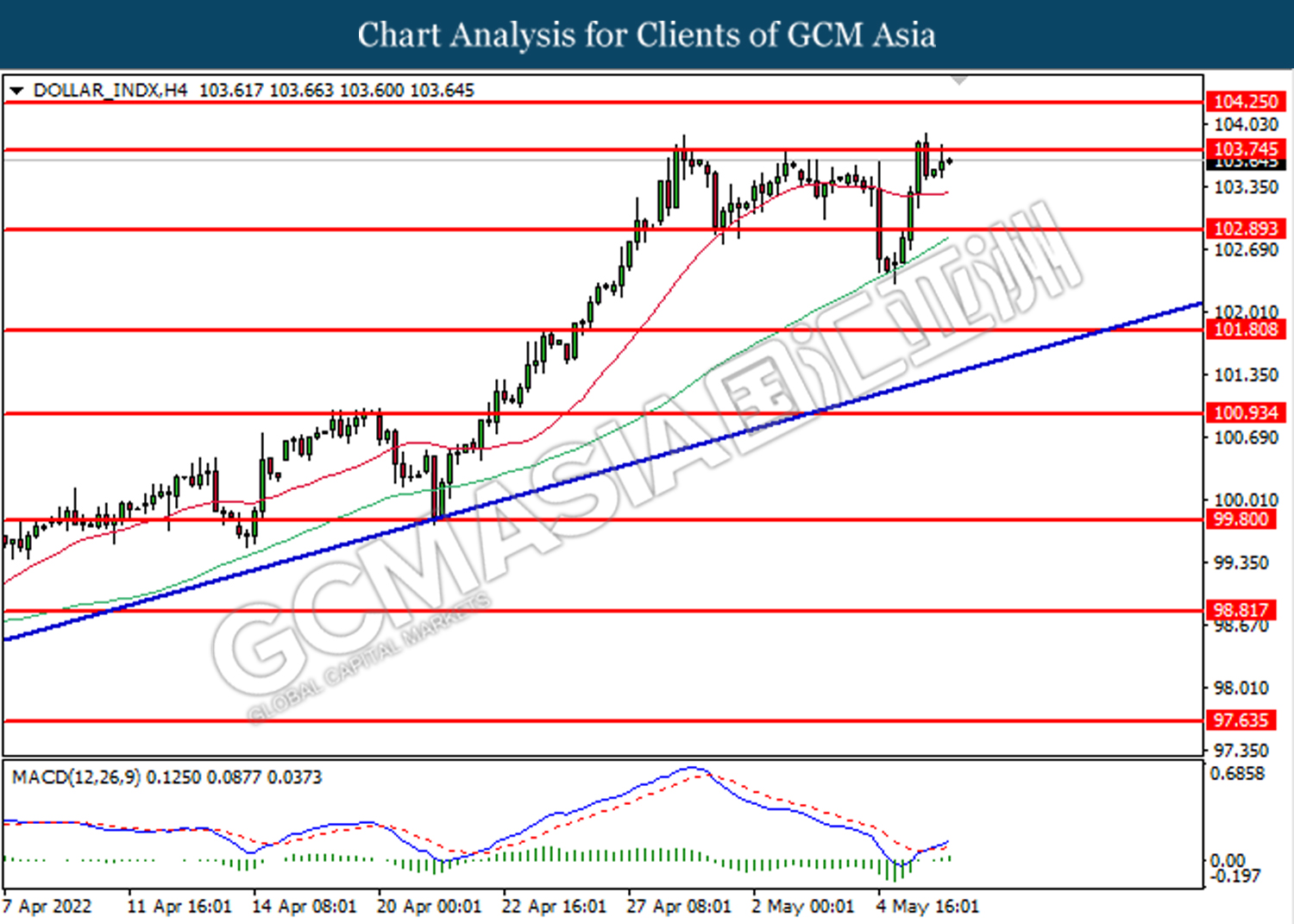

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 103.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.75, 104.25

Support level: 102.90, 101.80

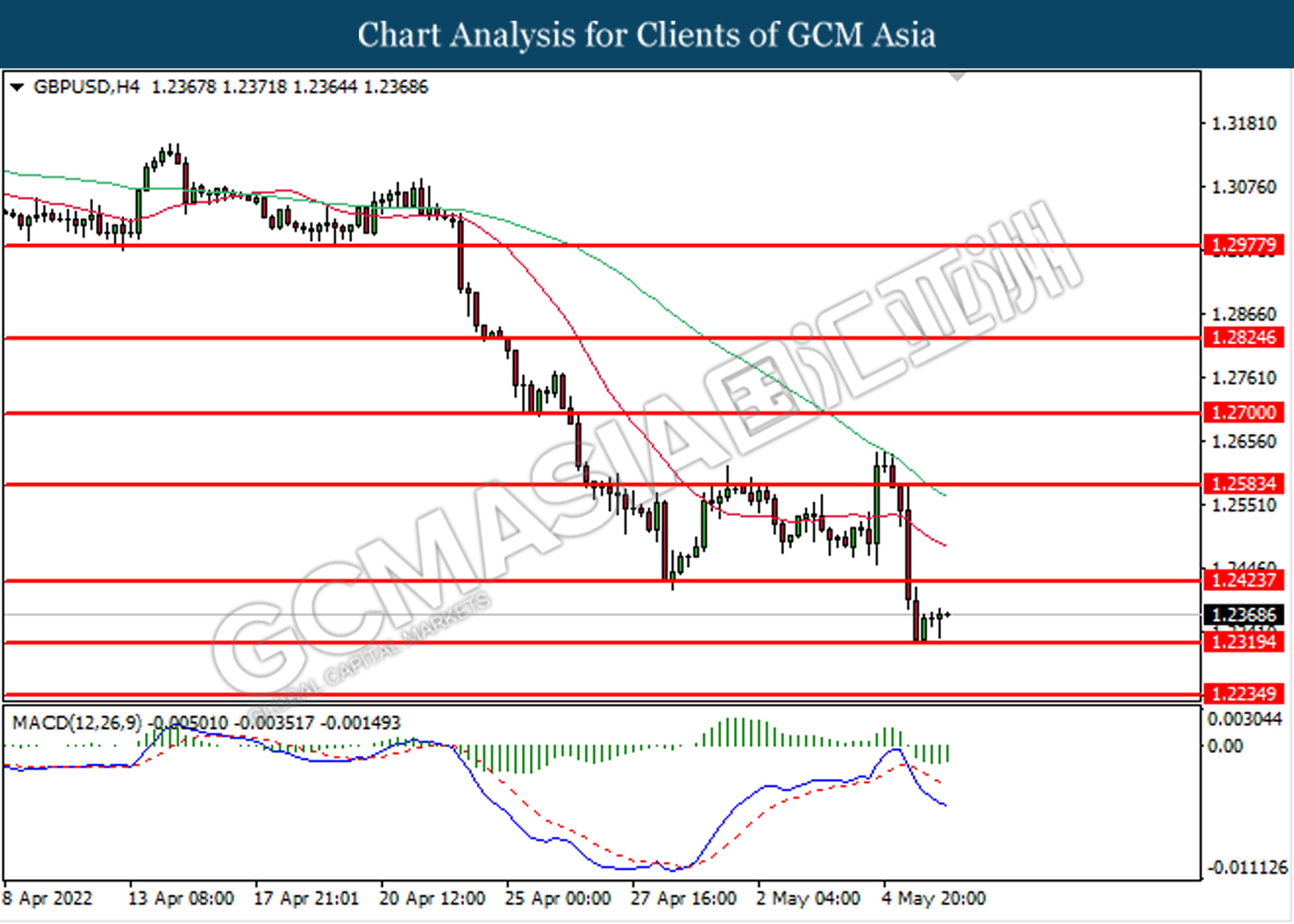

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2320. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2425.

Resistance level: 1.2425,1.2585

Support level: 1.2320, 1.2235

EURUSD, H4: EURUSD was traded lower following prior retracement near the resistance level at 1.0560. MACD which illustrated death cross signal suggest the pair to extend its losses toward the support level at 1.0490.

Resistance level: 1.0560, 1.0640

Support level: 1.0490, 1.0445

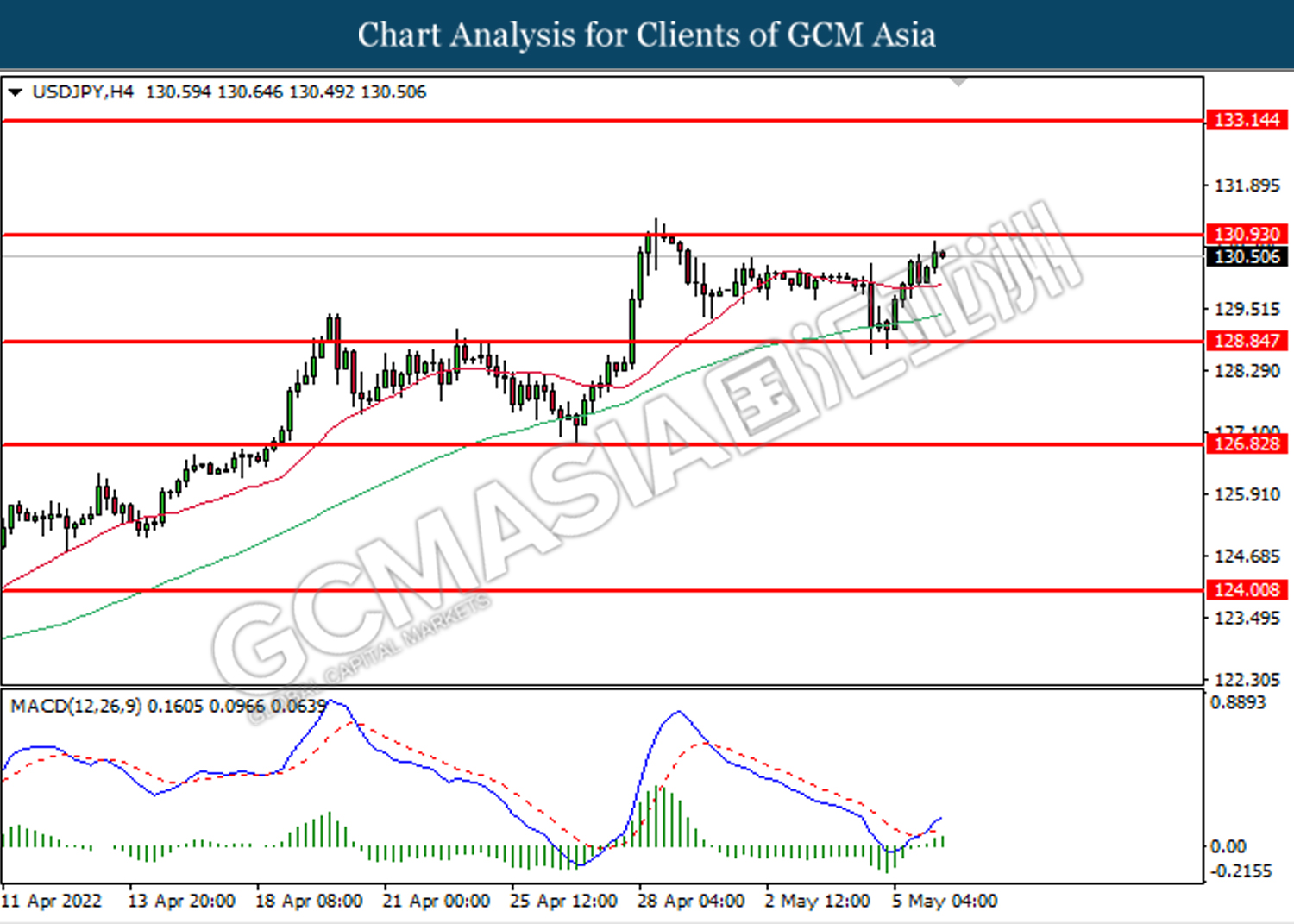

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 130.95. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after breakout happens.

Resistance level: 130.95, 133.15

Support level: 128.85, 126.85

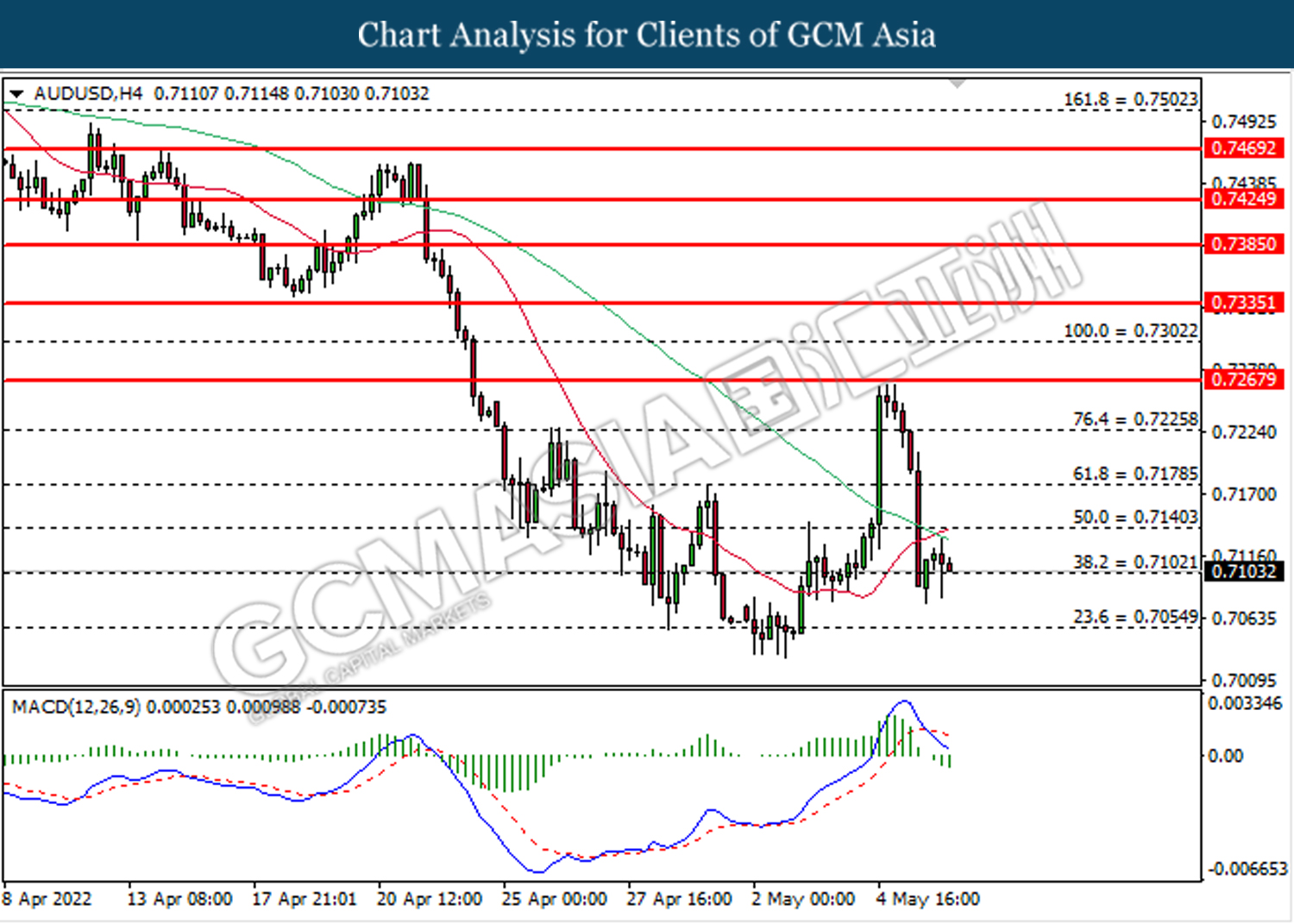

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7100. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6430, 0.6520

Support level: 0.6365, 0.6305

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2835. MACD which illustrated golden cross signal suggest the pair to extend its gains after its candle successfully closes above the resistance level.

Resistance level: 1.2835, 1.2910

Support level: 1.2785, 1.2715

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.9890.

Resistance level: 0.9890, 0.9950

Support level: 0.9825, 0.9725

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 109.05, 113.55

Support level: 99.50, 93.75

GOLD_, H4: Gold price was traded higher while retesting the previous support level at 1879.05. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1879.05, 1906.40

Support level: 1850.00, 1829.35

060522 Morning Session Analysis

6 May 2022 Morning Session Analysis

US Dollar surged amid the concerns for inflation risk.

The Dollar Index which traded against a basket of six major currencies surged on Thursday amid the concerns for inflation risk from the market, spurring further bullish momentum on the index. According to Reuters, investor sentiment cratered in the face of concerns that the Federal Reserve’s interest rate hike on the previous day would not be enough to combat surging inflation, which hinted that the market participants are expecting another aggressive rate hike from Fed in the next FOMC meetings in order to hedge with inflation risk. The rate hike decision from Fed would likely to increase the risk-free return of investors, sparkling the appeal for the US Dollar. Besides, as investors concern about the negative impacts of inflation risk, it dialed up the market optimism toward the safe-haven assets such as US Dollar, prompting investors to shift their capitals toward US Dollar which having better prospects. As of writing, the Dollar Index rallied by 0.97% to 103.59.

In commodities market, crude oil price appreciated by 0.45% to $108.75 per barrel as of writing over the Biden administration plans to buy 60 million barrels of crude oil as the first step in a multi-year process aimed at replenishing its emergency oil reserve. On the other hand, gold price edged up by 0.06% to $1876.87 per troy ounces as of writing. Nonetheless, the gold price still under pressure following the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 59.1 | 58 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 431K | 391K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.60% | 3.50% | – |

| 20:30 | CAD – Employment Change (Apr) | 72.5K | 55.0K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 74.2 | 60 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.60

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2435, 1.2520

Support level: 1.2345, 1.2265

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7160, 0.7205

Support level: 0.7075, 0.6995

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6495

Support level: 0.6400, 0.6355

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2830, 1.2875

Support level: 1.2775, 1.2710

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9880, 0.9910

Support level: 0.9825, 0.9780

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.05, 114.50

Support level: 107.25, 103.75

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1878.55, 1895.55

Support level: 1861.60, 1846.80

050522 Afternoon Session Analysis

5 May 2022 Afternoon Session Analysis

Pound lingers ahead of BoE Meeting.

Pound, one of the major currencies hovered near the one-week high level as market participants are still eyeing on the upcoming BoE (Bank of England) meeting. As of now, market consensus is expecting the BoE members to vote for 25 basis point hike, which would lift the Official Bank Rate to 1.00%. Prior to that, Governor of BoE – Andrew Bailey hinted that they will continue to maintain its current rate hike pace to support the economy to tide through the post pandemic inflation surge, which has been exacerbated by the Russia’s invasion of Ukraine. According to the latest data, UK annual inflation hit 7% in March as ongoing supply chain issue persists. Just like any other major central banks, BoE is facing the risk in curbing the overheated economy. At this juncture, the market participants and economist are waiting for the BoE meeting to gauge the further direction of the Pound. As of writing, the pair of GBP/USD dropped by 0.20% to 1.2600.

In commodities market, the crude oil price up by 0.44% to $108.45 per barrel despite oil inventories build unexpectedly. According to the EIA, U.S. Crude Oil Inventories up 1.302M, greater than the market expectation of -0.829M. On the other hand, gold price appreciated by 1.07% to $1901.35 per troy ounce amid dovish statement from Federal Reserve Chairman, Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Inflation Report

19:00 GBP BoE MPC Meeting Minutes

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | Composite PMI (Apr) | 57.6 | 57.6 | – |

| 16:30 | Services PMI (Apr) | 58.3 | 58.3 | – |

| 19:00 | BoE Interest Rate Decision (May) | 0.75% | 1.00% | – |

| 20:30 | Initial Jobless Claims | 180K | 182K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 103.60, 105.95

Support level: 100.85, 97.80

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2625, 1.2745

Support level: 1.2430, 1.2245

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.7260, 0.7510

Support level: 0.7020, 0.6720

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6550, 0.6720

Support level: 0.6400, 0.6260

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9850, 0.9930

Support level: 0.9715, 0.9575

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 108.35, 112.05

Support level: 104.20, 100.40

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1920.00, 1945.05

Support level: 1883.95, 1850.60

050522 Morning Session Analysis

5 May 2022 Morning Session Analysis

US Dollar beaten down following dovish tone from Federal Reserve.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday amid the backdrop of dovish speech from Federal Reserve. According to Reuters, Federal Reserve Chairman Jerome Powell played down the prospect of a 75 basis point rate hike, even as he said the U.S. central bank will act aggressively to stamp out inflation. Nonetheless, he reiterated that additional 50 basis point jumps should be on the table for the next couple of meetings. The diminishing of rate hike from Fed would likely to reduce the risk-free return of investors, stoked a shift sentiment toward other currencies which having better prospects. Besides, the war-driven inflation risk is unraveling whatever policy consensus there was between the world’s major central banks since the Great Financial Crisis and global markets could buckle under resulting waves of stress and volatility. The strengthening US Dollar which often both reflects and fuels financial market stress, risks a vicious cycle as a scramble for dollars intensifies, tightens global financial conditions and increases volatility, according to Reuters. It dialed down the market optimism toward US Dollar, which spurring further bearish momentum on it. As of writing, the Dollar Index eased by 0.93% to 102.53.

In commodities market, crude oil price appreciated by 0.33% to $108.17 per barrel as of writing over EU proposed a phase of sanction on Russian oil. On the other hand, gold price rallied by 1.02% to $1887.92 per troy ounces as of writing following the US Dollar was dragged down.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Inflation Report

19:00 GBP BoE MPC Meeting Minutes

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | Composite PMI (Apr) | 57.6 | 57.6 | – |

| 16:30 | Services PMI (Apr) | 58.3 | 58.3 | – |

| 19:00 | BoE Interest Rate Decision (May) | 0.75% | 1.00% | – |

| 20:30 | Initial Jobless Claims | 180K | 182K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its losses.

Resistance level: 105.60, 103.15

Support level: 101.85, 101.05

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2625, 1.2705

Support level: 1.2520, 1.2435

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0655, 1.0740

Support level: 1.0575, 1.0505

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses if successfully breakout the support level.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7270, 0.7345

Support level: 0.7205, 0.7160

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6630

Support level: 0.6540, 0.6495

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2775, 1.2830

Support level: 1.2710, 1.2655

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9745, 0.9780

Support level: 0.9715, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.05, 114.50

Support level: 107.25, 103.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1897.25, 1907.10

Support level: 1883.80, 1872.30

290422 Afternoon Session Analysis

29 April 2022 Afternoon Session Analysis

USDJPY spiked over dovish tone from Bank of Japan.

USDJPY surged to its recent high yesterday amid the backdrop of dovish statement from Bank of Japan (BoJ), which spurred further bullish momentum on the pair. According to Reuters, the BoJ strengthened its commitment on Thursday to keep interest rates ultra-low by vowing to buy unlimited amounts of bonds daily to defend its yield target. Besides, Lee Hardman, a currency analyst at MUFG Bank in London has claimed that the BoJ gave the ‘all clear’ to continue selling the yen. The ultra-low interest rate in Japan would diminish the risk-off return of the investors, dialed down the market optimism toward Japanese Yen. Furthermore, the low interest rate was implemented as economic progression of a country was bad, indicating the economic progression of Japan might be worse than the market expectation, prompting investors to shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, USDJPY edged down by 0.10% to 130.72

In commodities market, crude oil price depreciated by 0.28% to $105.05 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish following the supply disruption fears as Western sanctions curb crude and products exports from Russia underpinned prices. On the other hand, gold price appreciated by 0.51% to $1900.90 per troy ounces as of writing over the soaring inflation driven up inflation-hedged assets demand such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q1) | -0.30% | 0.20% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.40% | 7.40% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.20% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 104.30

Support level: 103.15, 102.60

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2520, 1.2625

Support level: 1.2435, 1.2345

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains

Resistance level: 0.7160, 0.7205

Support level: 0.7105, 0.7055

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6540, 0.6590

Support level: 0.6495, 0.6460

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2830, 1.2875

Support level: 1.2775, 1.2710

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9745, 0.9780

Support level: 0.9715, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.25, 111.05

Support level: 103.75, 100.15

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1907.10, 1918.85

Support level: 1897.25, 1883.80

290422 Morning Session Analysis

29 April 2022 Morning Session Analysis

US Dollar surged on risk-off mood.

The Dollar Index which traded against a basket of six major currencies extend its gains amid the rising tensions between Russia-Ukraine issues continue to weigh down the economic prospect in the European region, which stoked a shift in sentiment toward the safe-haven US Dollar. According to Wall Street Journal, Germany is now ready to stop buying Russian oil, clearing the way for a European Union ban on crude imports from Russia. The compromise from Germany would likely to increase the likelihood that EU countries will agree on a phased-in embargo on Russian oil, with a decision possible as soon as next week. The implementation of sanction would jeopardize the global economic growth as well as sparked further stagflation risk in future. Nonetheless, the gains experienced by the US Dollar was limited by bearish economic data. According to Bureau of Economic Analysis, US Gross Domestic Product (GDP) for last quarter came in at -1.4%, missing the market forecast at 1.1%. As of writing, the Dollar Index surged 0.69% to 103.67.

In the commodities market, the crude oil price extends its gains by 0.10% to $105.35 per barrel as of writing. The oil market received significant bullish momentum yesterday as market participants speculated that the EU would implement sanction on Russian oil supply in the short-term basis. On the other hand, the gold price appreciated by 0.02% to $1894.15 per troy ounces amid risk-off sentiment in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q1) | -0.30% | 0.20% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.40% | 7.40% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.20% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 103.60, 105.95

Support level: 100.85, 97.80

GBPUSD, Weekly: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2625, 1.2935

Support level: 1.2245, 1.2010

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 132.30, 124.75

Support level: 129.45, 127.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7260, 0.7510

Support level: 0.7020, 0.6720

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6550, 0.6720

Support level: 0.6400, 0.6260

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9715, 0.9825

Support level: 0.9575, 0.9455

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 105.50, 107.70

Support level: 102.95, 100.40

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1920.00, 1945.05

Support level: 1883.95, 1850.60

280422 Afternoon Session Analysis

28 April 2022 Afternoon Session Analysis

Euro beaten down amid gas cut-off from Russia.

Euro eased to its recent low since yesterday following the gas cut-off from Russia to Europe. According to Reuters, Ukraine appeared a speech that Europe should stop depending on Russia for trade after Moscow halted gas supplies to Bulgaria and Poland for not paying in roubles, as the shutoff exposed the continent’s weaknesses and divisions on Wednesday. Gazprom, Russia’s gas export monopoly, suspended gas supplies “due to absence of payments in roubles”, as stipulated in a decree from Russian President Vladimir Putin that aims to soften the impact of sanctions. As Europe was the largest dependent on the Russia commodities, the diminishing commodities such as natural gas would drag down the economic activities in Europe region, leading to the disruption of domestic productivity. It dialed down the market optimism toward economic progression in Europe, prompting investors to selloff Euro. Besides, the hawkish tone from Federal Reserve would likely reduce the US Dollar circulation in the market, sparkling the appeal for the US Dollar and spurring further bearish momentum on the Euro. As of writing, EURUSD depreciated by 0.19% to 1.0534.

In commodities market, crude oil price slumped by 1.52% to $100.50 per barrel as of writing amid Some of Europe’s largest energy companies are making arrangements to comply with a new payment system for Russian gas sought by the Kremlin, which may lead to the surge of oil supply. On the other hand, gold price depreciated by 0.47% to $1880.00 per troy ounces as of writing over the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Outlook Report (YoY)

Tentative JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 6.90% | 1.10% | – |

| 20:30 | USD – Initial Jobless Claims | 184K | 180K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 103.75, 104.30

Support level: 103.15, 102.60

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2520, 1.2625

Support level: 1.2435, 1.2345

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7105, 0.7160

Support level: 0.7055, 0.6995

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6540, 0.6590

Support level: 0.6495, 0.6460

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2875, 1.2910

Support level: 1.2830, 1.2775

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9715, 0.9745

Support level: 0.9680, 0.9640

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 103.75, 107.25

Support level: 100.15, 96.65

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1883.80, 1897.25

Support level: 1872.30, 1860.30

280422 Morning Session Analysis

28 April 2022 Morning Session Analysis

US Dollar surged amid hawkish bet on Fed.

The Dollar Index which traded against a basket of six major currencies surged to its highest level since the pandemic began as hawkish expectation from Federal Reserve continue to linger in the financial market. Investor bet on an aggressive path of contractionary monetary policy from Fed following the Fed Chairman Jerome Powell confirmed that the central bank would be increasing their interest rates by 50 basis points in May. Besides, the recent hawkish tone from Fed members have stoked speculation on whether the central bank will hint a much larger 75 basis point to combat the spiking inflation risk. In addition, the US Dollar extend its gains as risk-off sentiment in global financial market following Russia’s Gazprom halted gas supplies to Poland and Bulgaria on Wednesday over their failure to pay in rubles, sparked higher stagflation risk in future. As of writing, the Dollar Index appreciated by 0.67% to 102.99.

In the commodities market, the crude oil price surged 0.03% to $102.45 per barrel as of writing over the backdrop of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at 0.692M, lesser than the market forecast at 2.000M. On the other hand, the gold price depreciated by 0.02% to $1885.95 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Outlook Report (YoY)

Tentative JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 6.90% | 1.10% | – |

| 20:30 | USD – Initial Jobless Claims | 184K | 180K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded l lower as technical correction.

Resistance level: 103.05, 103.75

Support level: 102.20, 101.20

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2800, 1.2995

Support level: 1.2545, 1.2310

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0845, 1.1155

Support level: 1.0550, 1.0300

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7215, 0.7385

Support level: 0.7115, 0.6985

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6605, 0.6705

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9705, 0.9825

Support level: 0.9575, 0.9455

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 102.95, 105.50

Support level: 100.40, 97.85

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1920.00, 1945.05

Support level: 1883.95, 1850.60

270422 Afternoon Session Analysis

27 April 2022 Afternoon Session Analysis

Euro under pressure amid rising stagflation risk.

EURUSD extend its losses on Wednesday over the backdrop of the spike of crude oil price. According to Reuters, China’s central bank claimed on Tuesday, which it will step up prudent monetary policy support to its economy as Beijing races to stamp out a nascent COVID-19 outbreak in the capital and avert the same debilitating city-wide lockdown that has shrouded Shanghai for a month. The move from China central bank would boost up economic activities in China, leading to the increasing demand of crude oil. Nonetheless, the surge of crude oil price had brought negative prospects toward Euro. As Europe was one of the dependent on commodities such as crude oil, rising oil price would increase the import costs of companies in Europe region, and it would reduce the profit margin of the companies indirectly. It dialed down the market optimism toward economic progression in Europe region, prompting investors to shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, EURUSD edged up by 0.04% to 1.0640.

In commodities market, crude oil price rallied by 0.70% to 102.41 per barrel as of writing following the China economic stimulus would likely to increase oil demand. Besides, gold price depreciated by 0.27% to 1898.90 per troy ounces as of writing amid the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | Pending Home Sales (MoM) (Mar) | – | -1.50% | -4.10% |

| 22:30 | Crude Oil Inventories | – | 2.471M | -8.020M |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.60, 103.15

Support level: 101.95, 101.20

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2625, 1.2695

Support level: 1.2520, 1.2435

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0655, 1.0715

Support level: 1.0575, 1.0505

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 128.00, 129.05

Support level: 127.05, 126.10

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7235, 0.7300

Support level: 0.7160, 0.7105

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6590, 0.6630

Support level: 0.6540, 0.6495

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2830, 1.2875

Support level: 1.2775, 1.2700

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9640, 0.9680

Support level: 0.9605, 0.9555

CrudeOIL, H4: Crude oil price was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 103.75, 107.25

Support level: 100.15, 96.65

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1905.15, 1917.70

Support level: 1890.40, 1878.25