270422 Morning Session Analysis

27 April 2022 Morning Session Analysis

US Dollar appreciated as stagflation risk lingered in global market.

The Dollar Index which traded against a basket of six major currencies surged amid concerns about the recession in the global economic as well as the hawkish expectation upon the Federal Reserve will continue to boost market demand on the safe-haven Dollar. Currently, Beijing had ramped up plans for massive-testing of 20 million people and spurred further worries about a looming lockdown in future in order to combat the spiking number of Covid-19 cases. Besides, the US Stock Index were closing at its lowest level since December 2020 amid the rising US Treasury yield continue to drag down the appeal for the equity market. On the economic data front, the US Dollar extend its gains over the backdrop of upbeat economic data. According to Census Bureau, US Core Durable Goods Orders for last month notched up significantly from the previous reading of -0.5% to 1.1%, exceeding the market forecast at 0.6%. Such upbeat economic data had sparked further inflation risk in future, increasing the probability for the aggressive contractionary monetary policy in future. As of writing, the Dollar Index appreciated by 0.54% to 102.30.

In the commodities market, the crude oil price depreciated by 0.03% to $102.50 during the early Asian trading hours following the released of bearish inventory data. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at 4.780M, exceeding the market forecast at 2.167M. On the other hand, the gold market appreciated by 0.03% to $1905.85 per troy ounces amid stagflation risk in the financial market had boosted up market demand on safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | Pending Home Sales (MoM) (Mar) | – | -1.50% | -4.10% |

| 22:30 | Crude Oil Inventories | – | 2.471M | -8.020M |

Technical Analysis

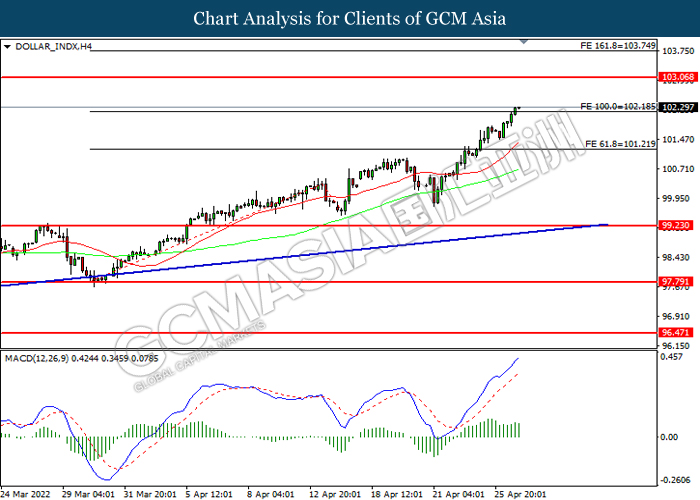

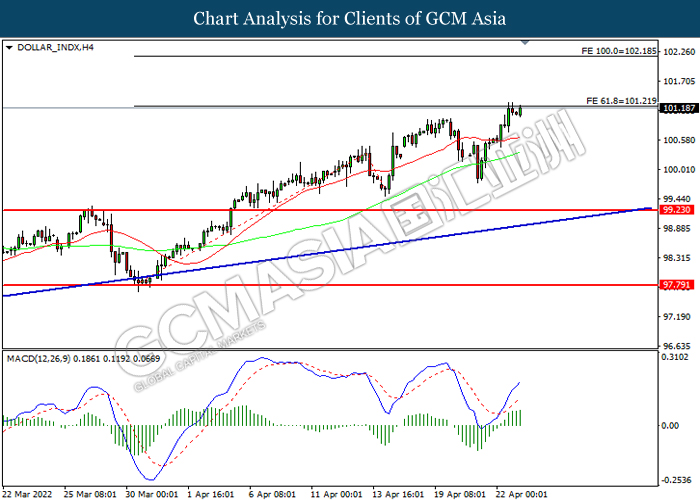

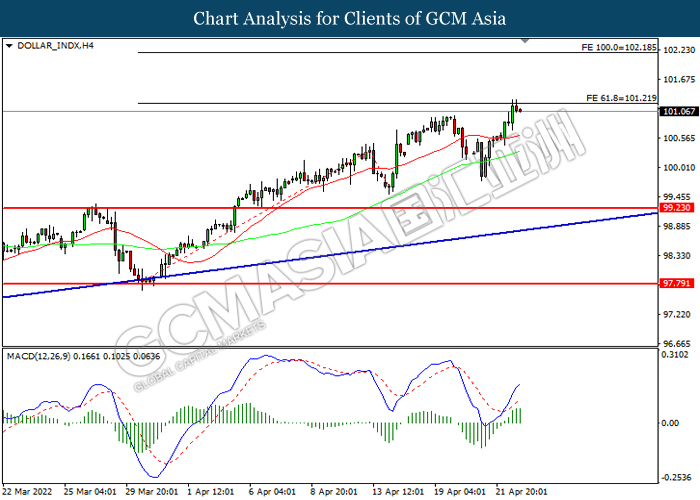

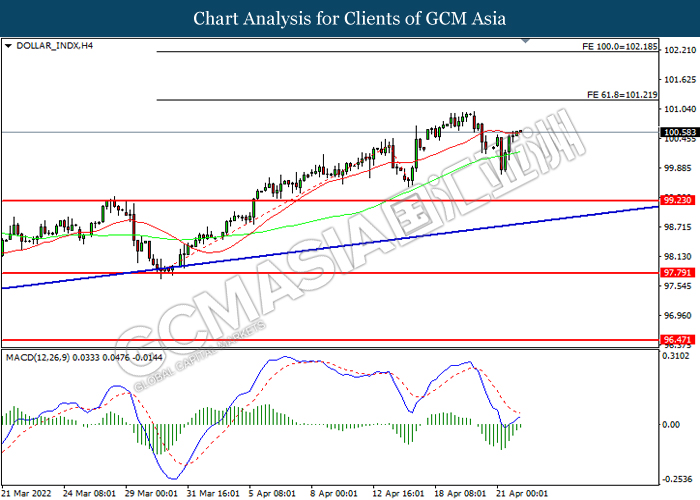

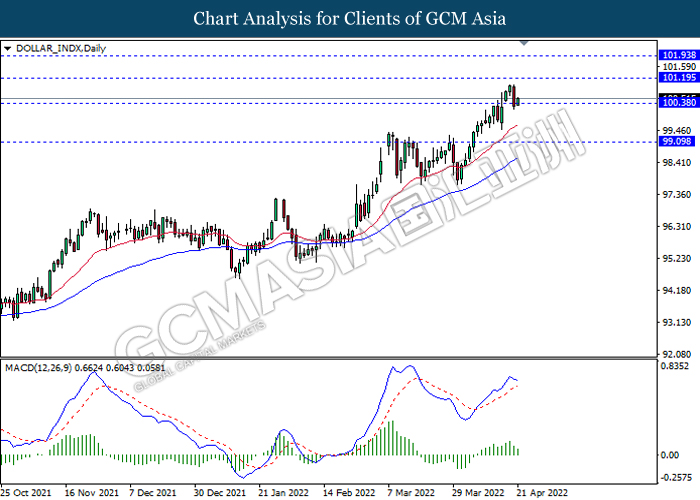

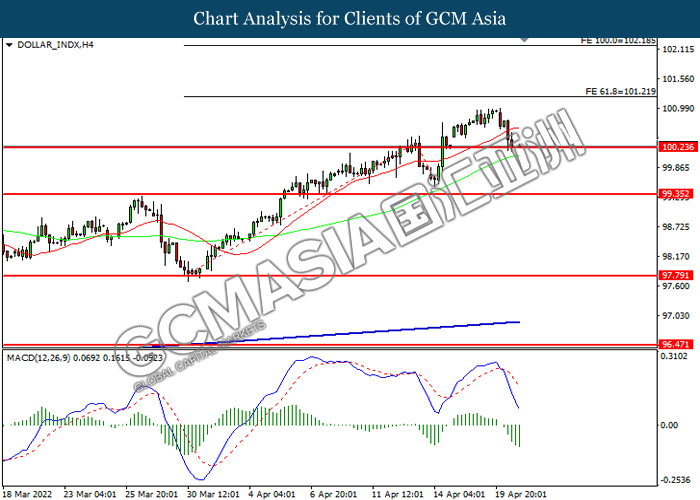

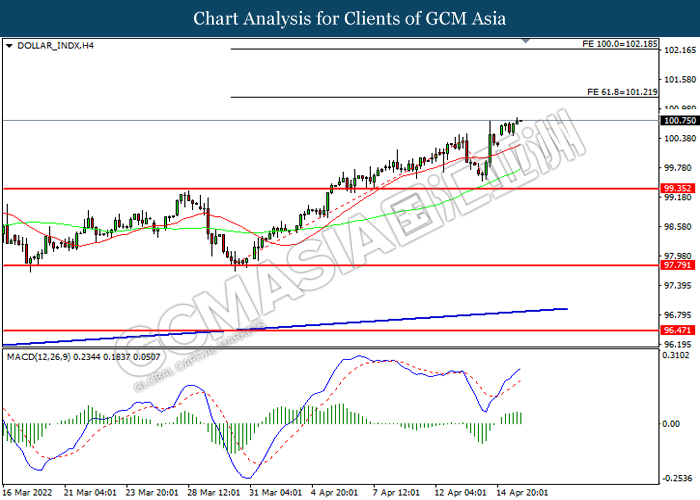

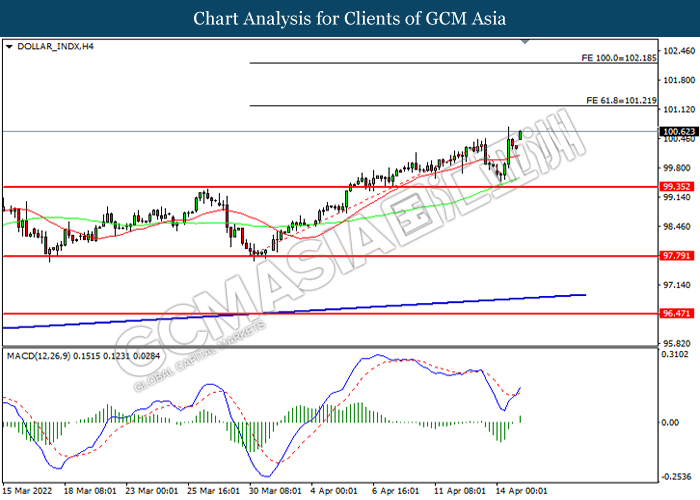

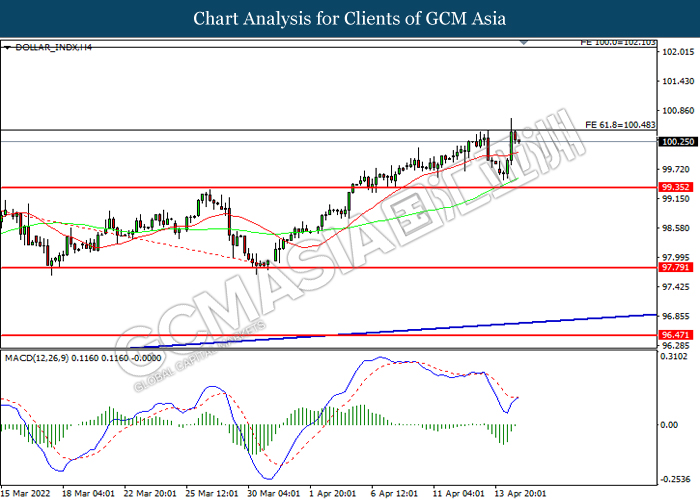

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.05, 103.75

Support level: 101.20, 99.25

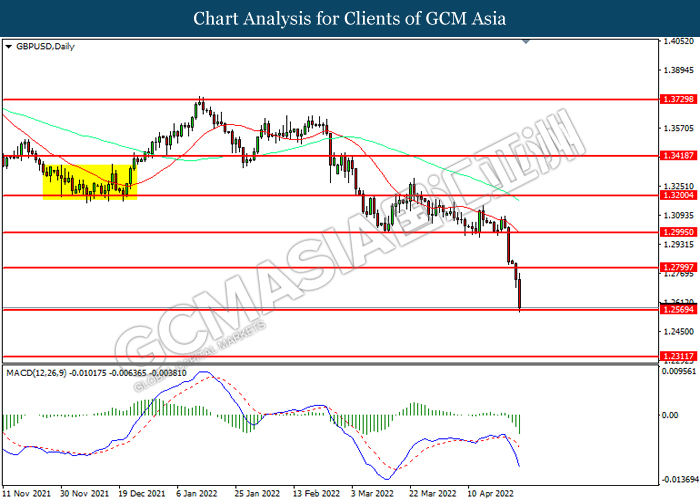

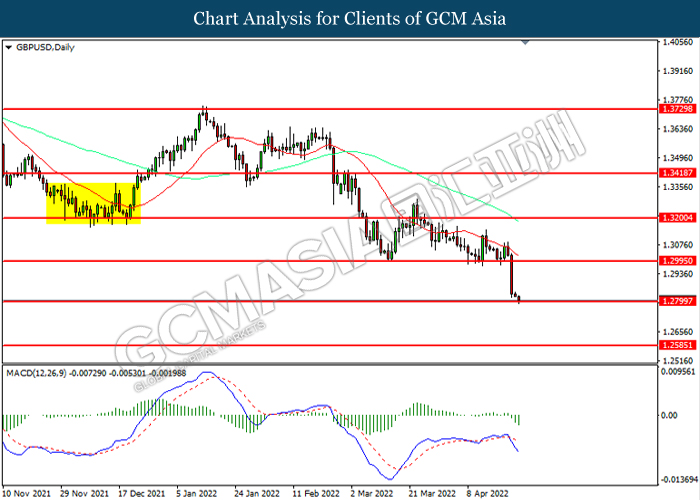

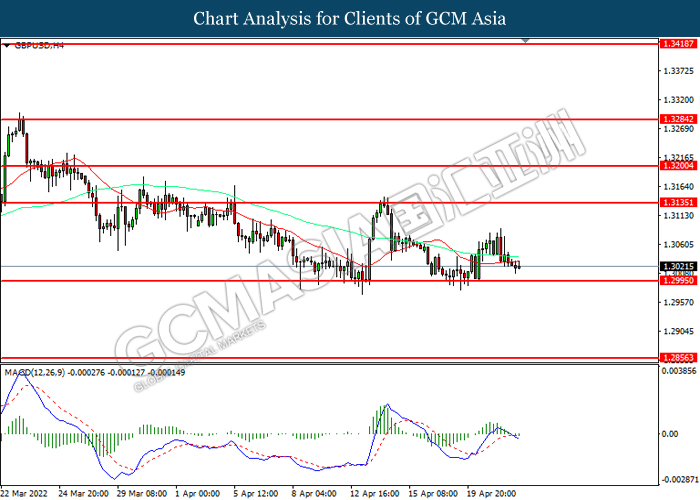

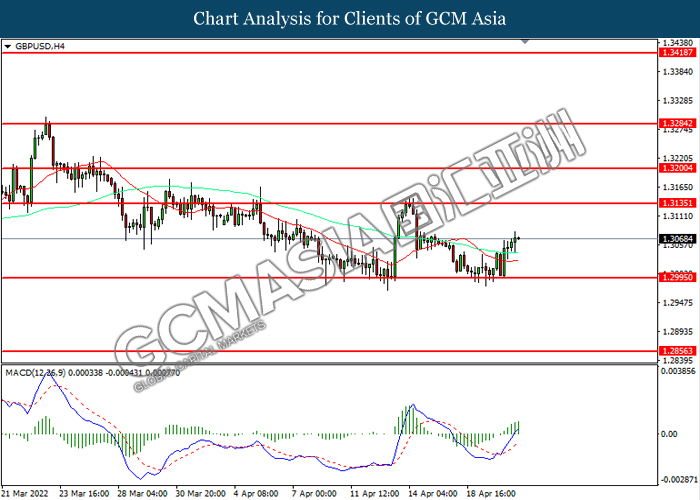

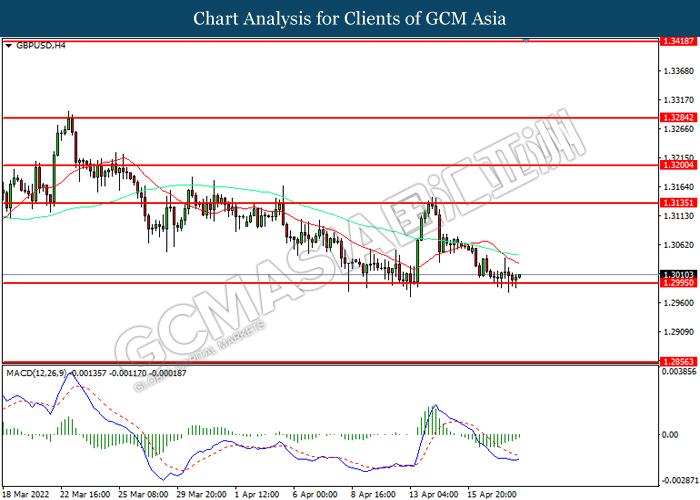

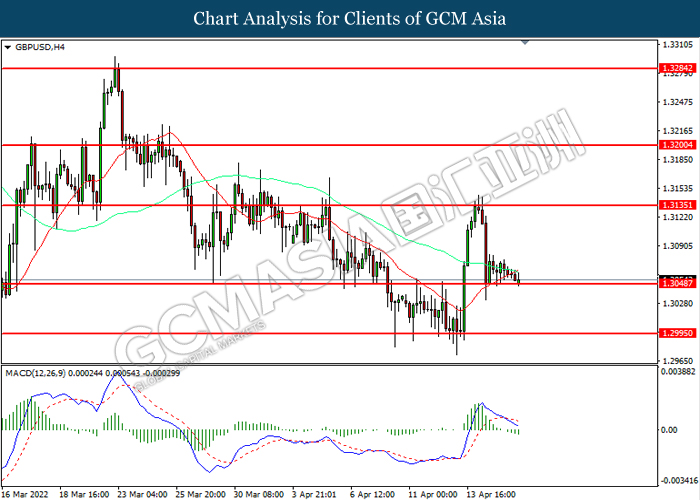

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2800, 1.2995

Support level: 1.2570, 1.2310

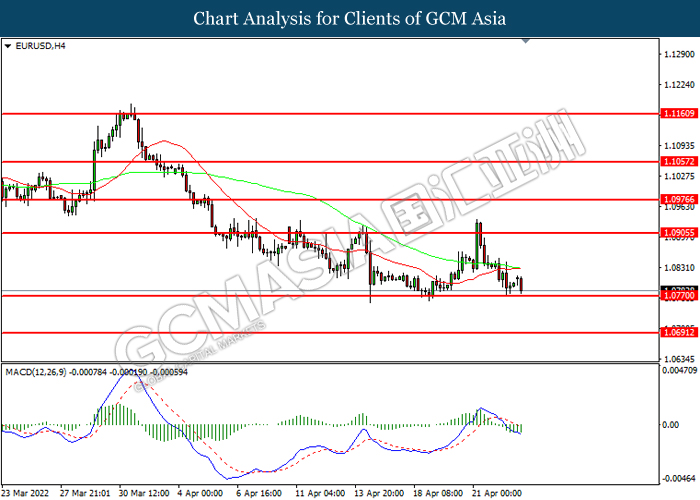

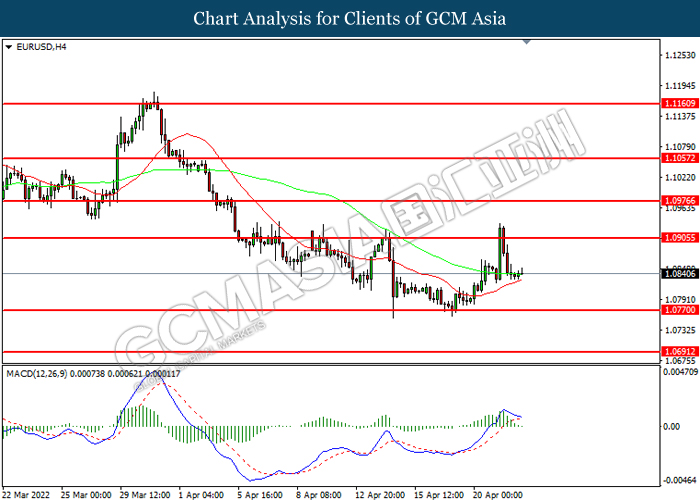

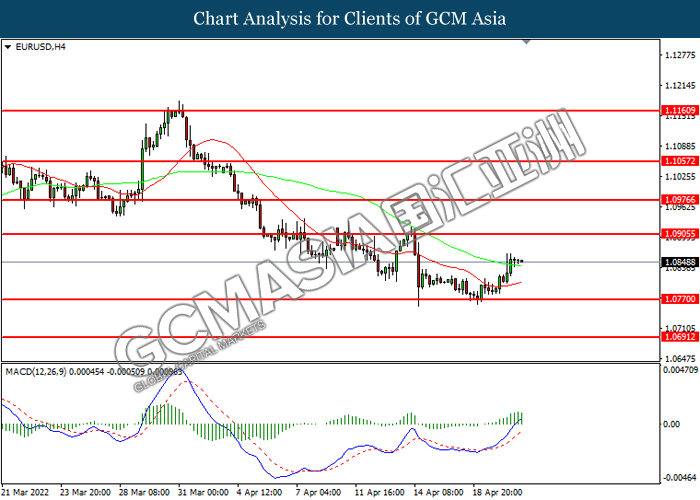

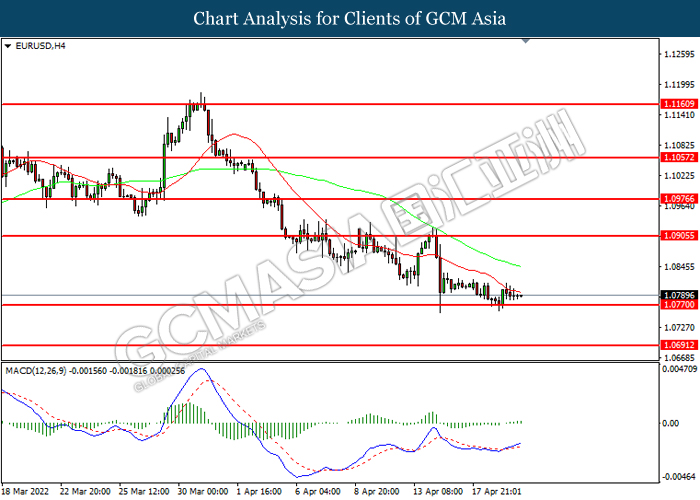

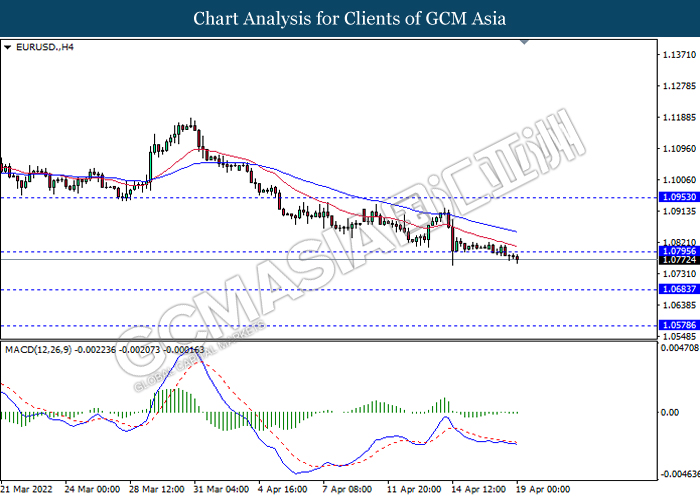

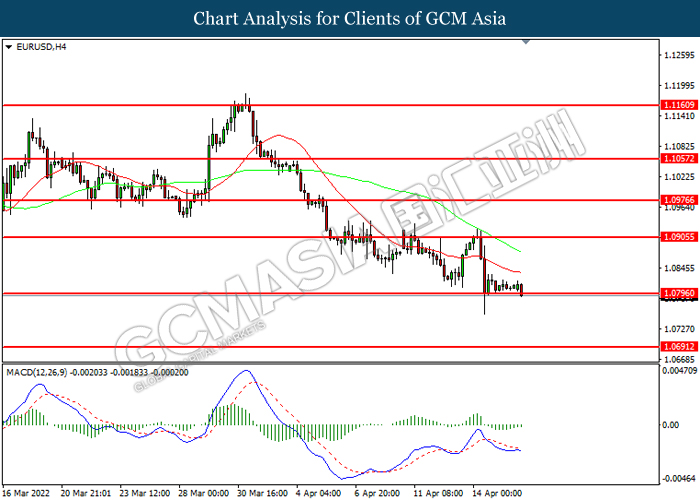

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend tis losses toward support level.

Resistance level: 1.0845, 1.1155

Support level: 1.0550, 1.0300

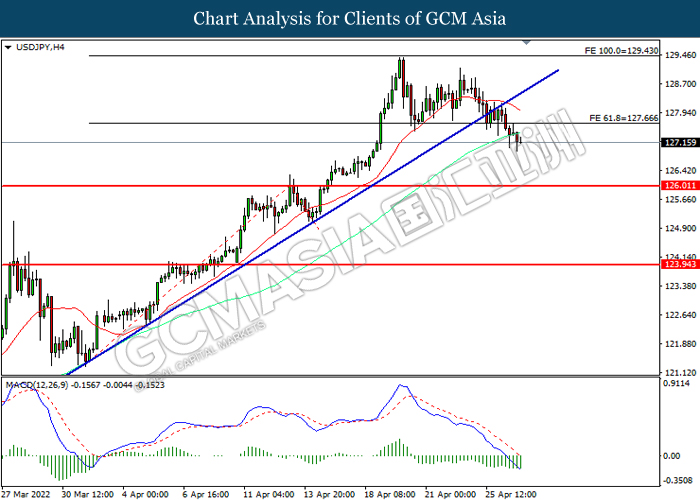

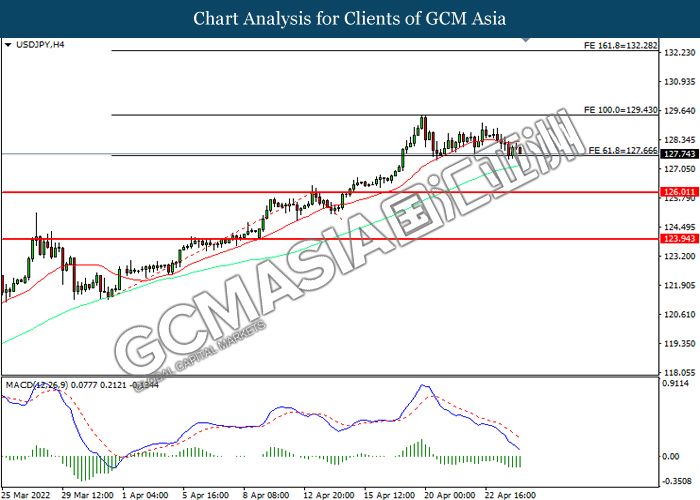

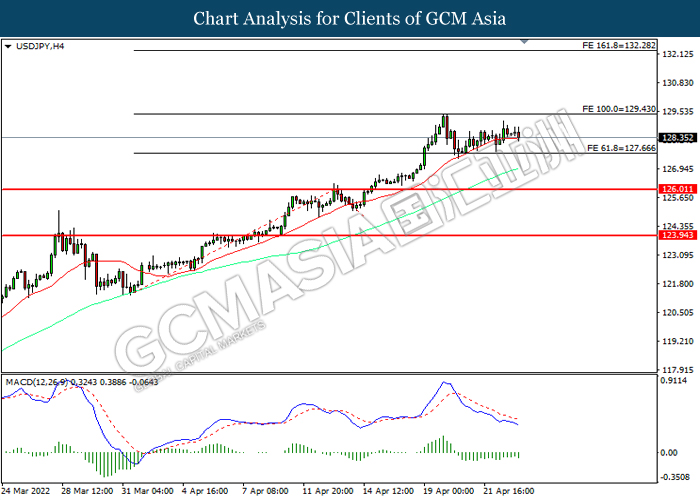

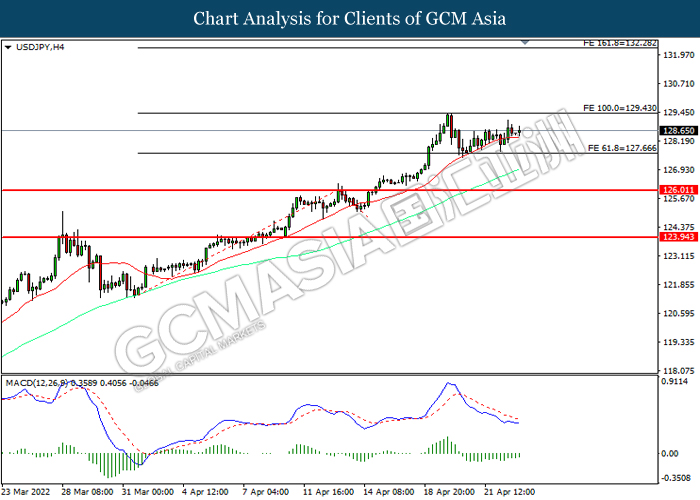

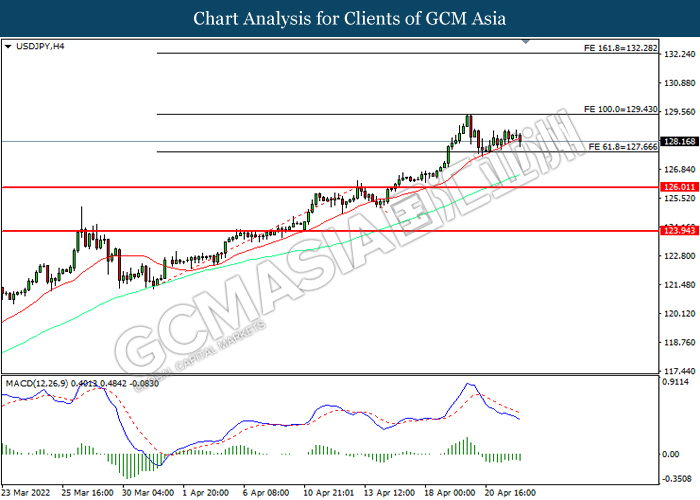

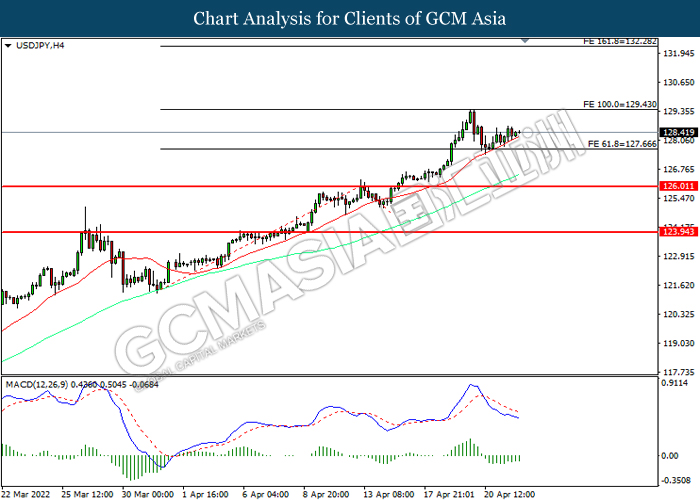

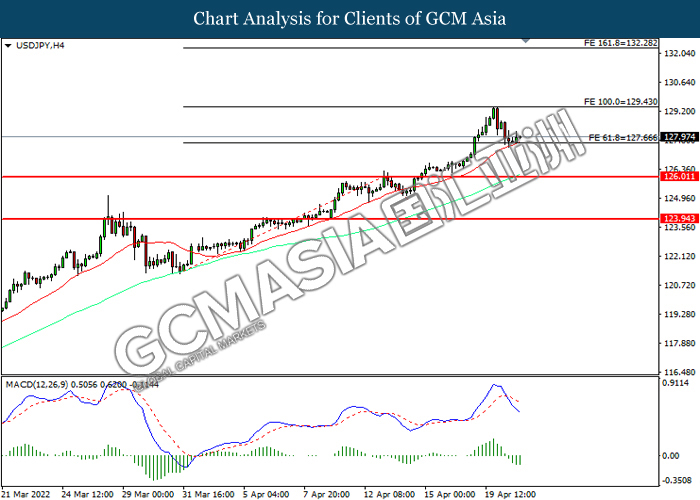

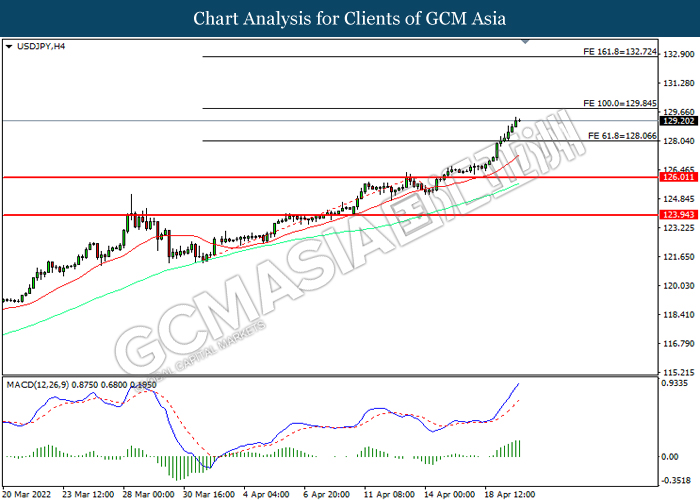

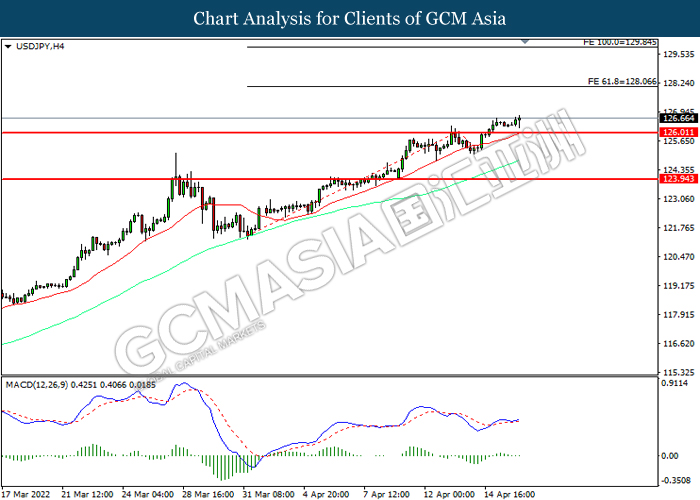

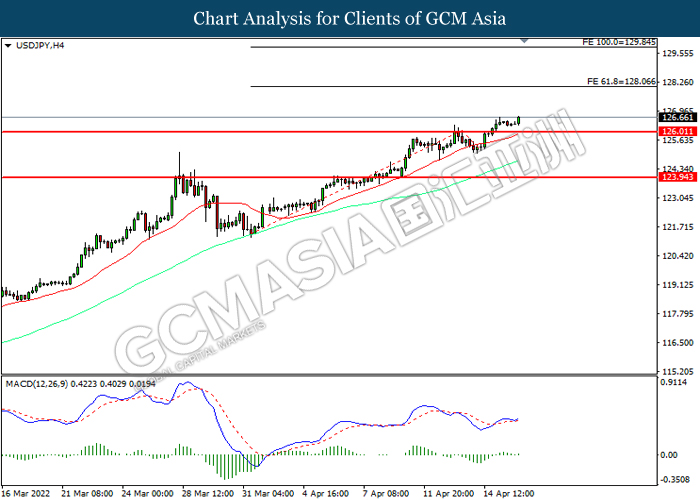

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 127.65, 129.45

Support level: 126.00, 123.95

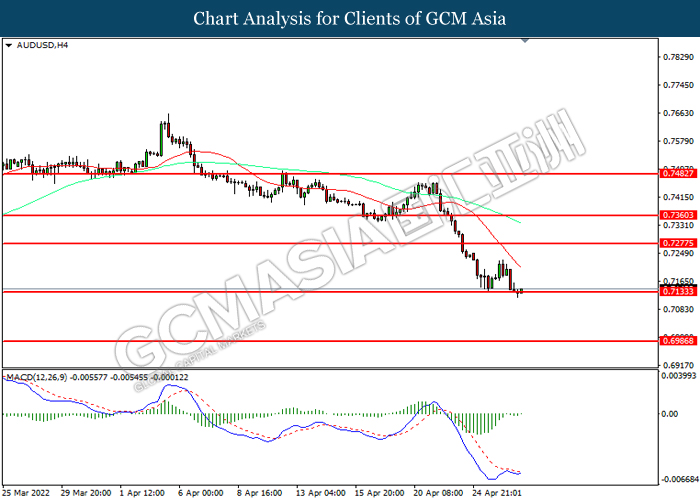

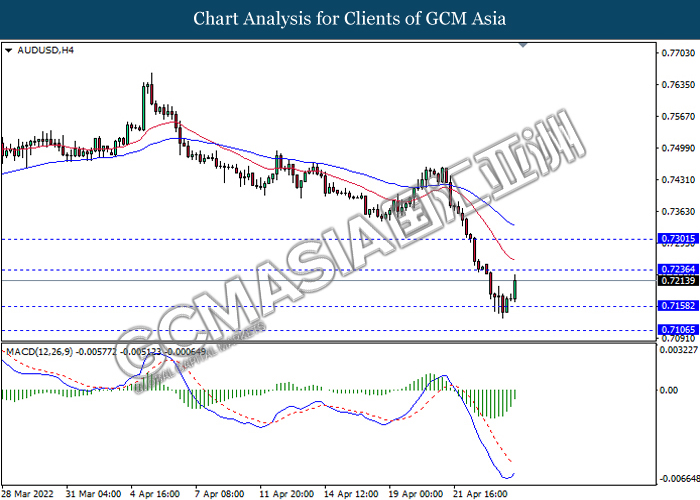

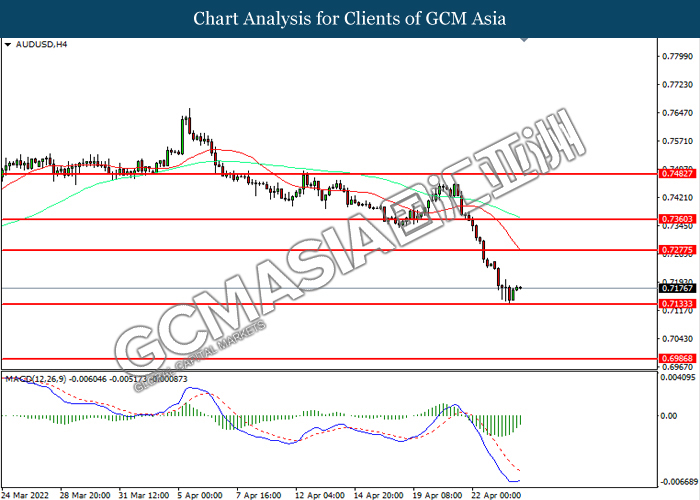

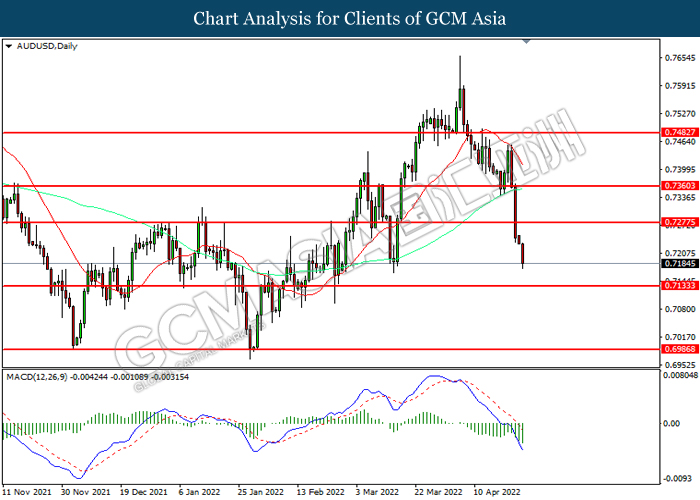

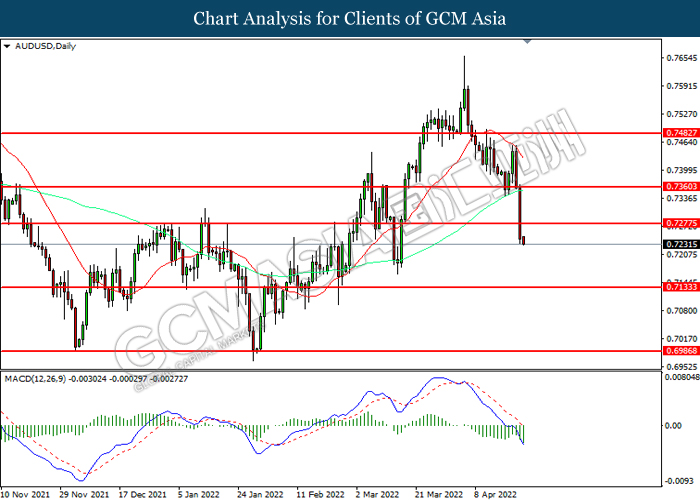

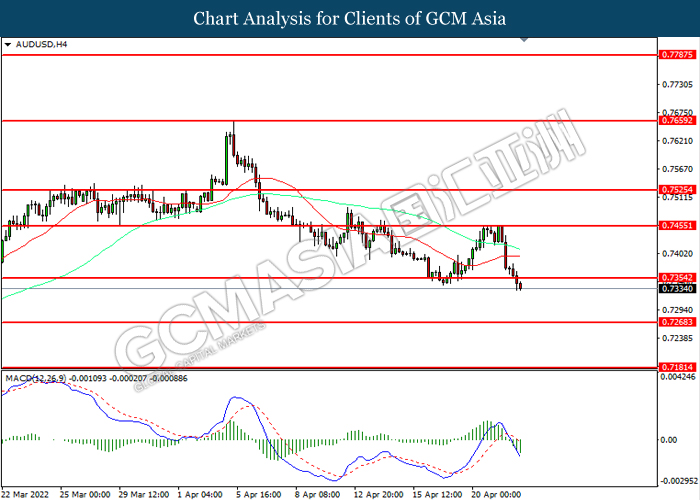

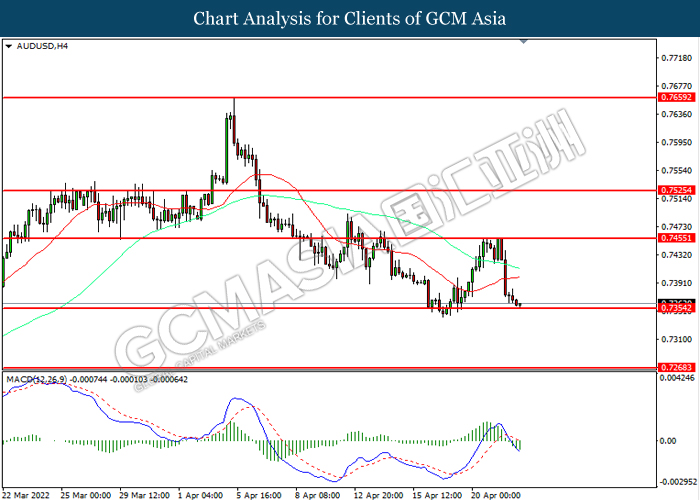

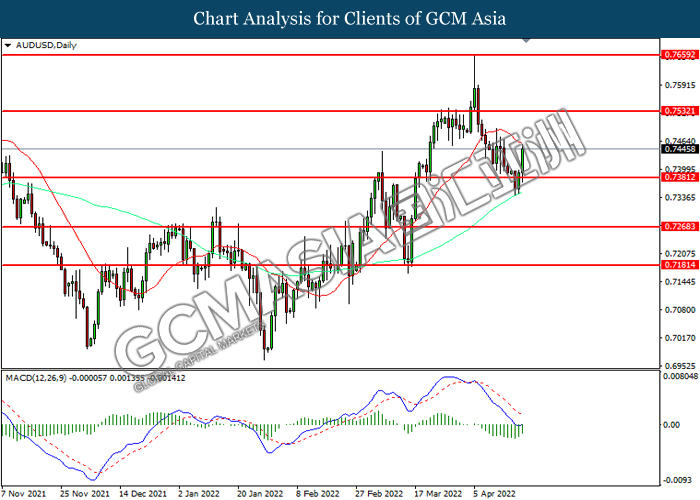

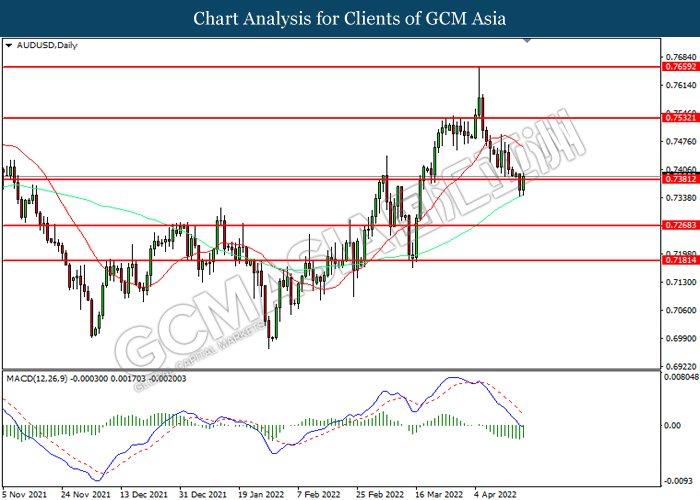

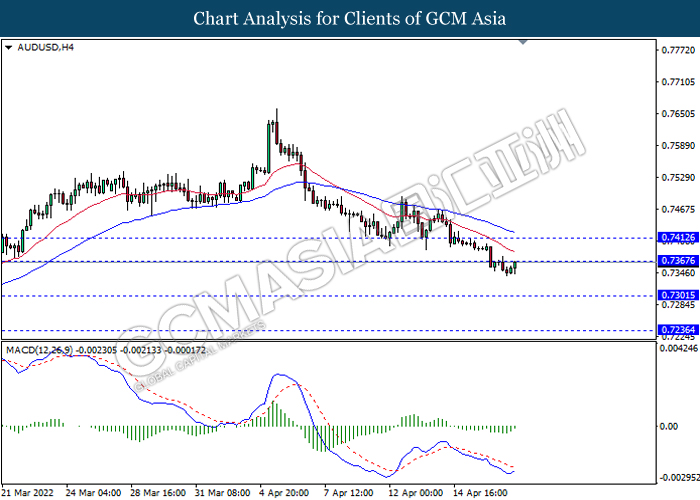

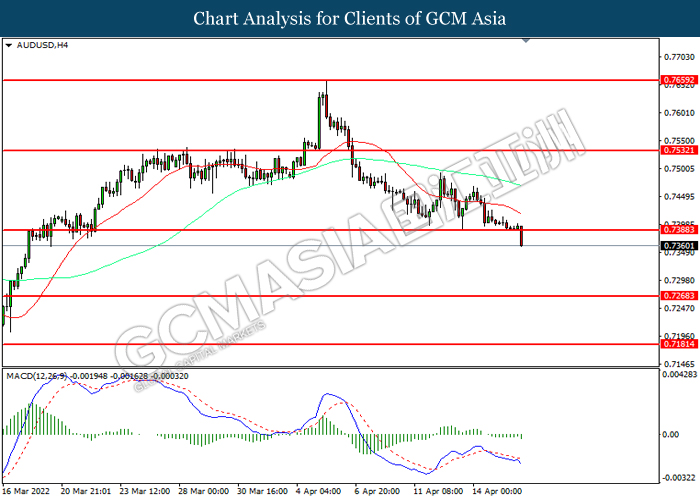

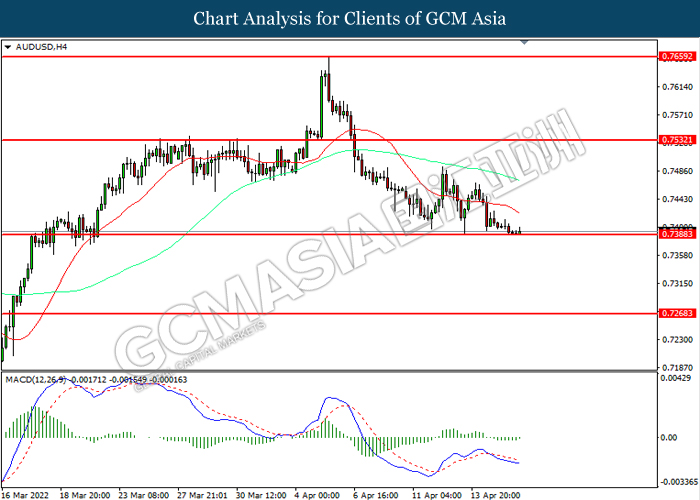

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7280, 0.7360

Support level: 0.7135, 0.6985

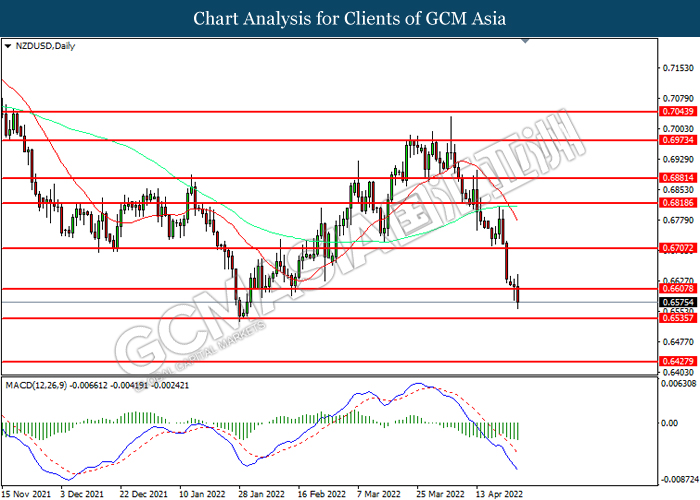

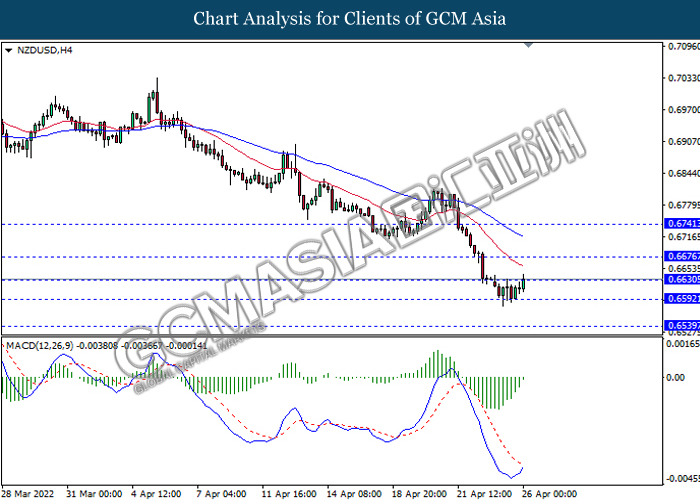

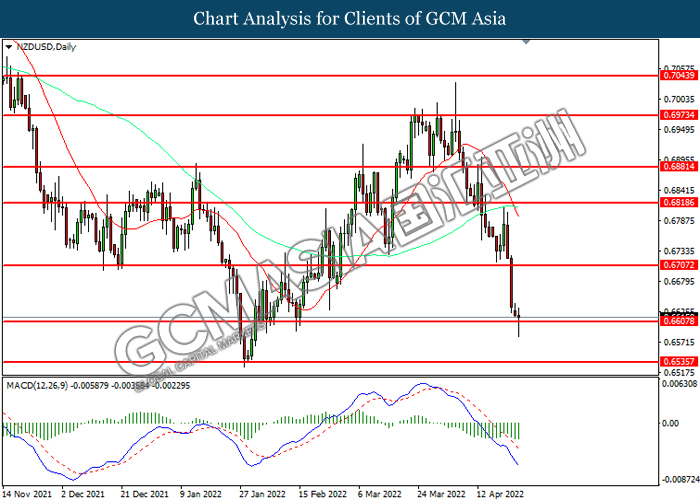

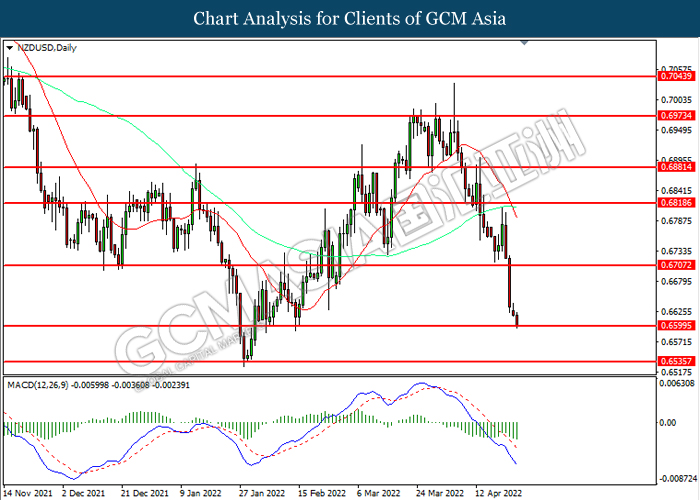

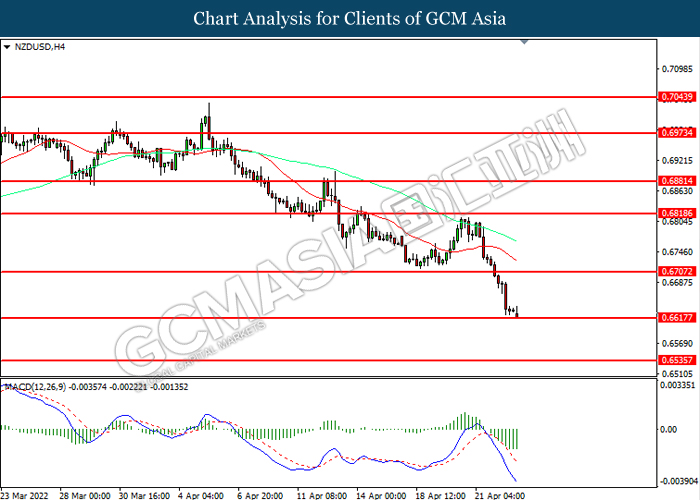

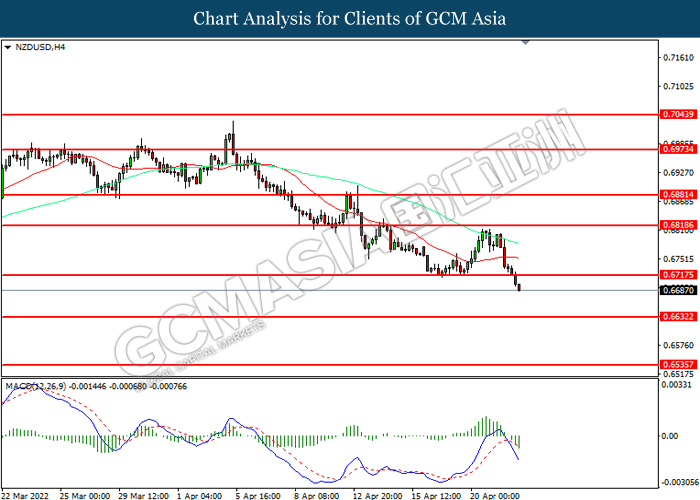

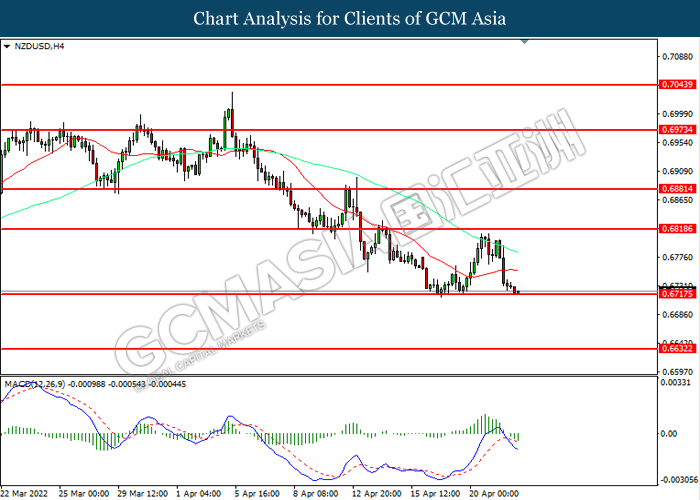

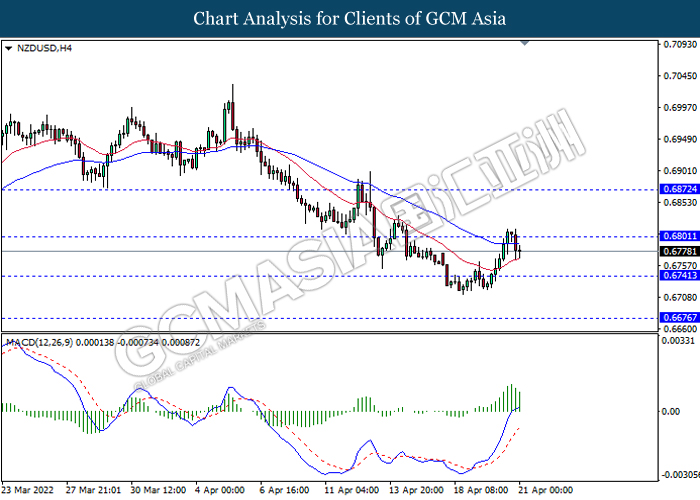

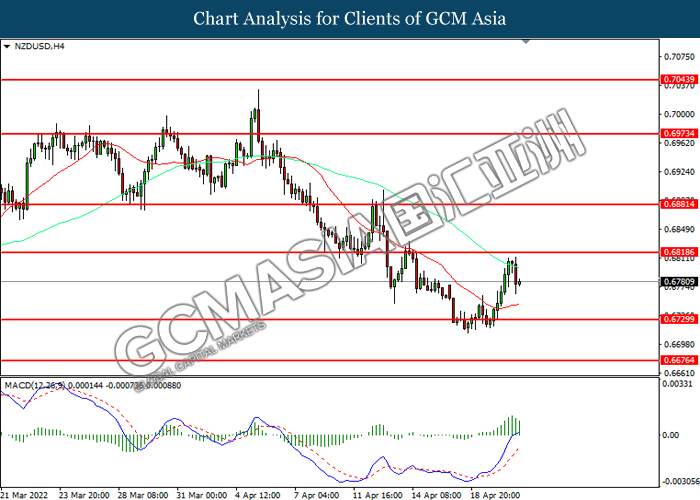

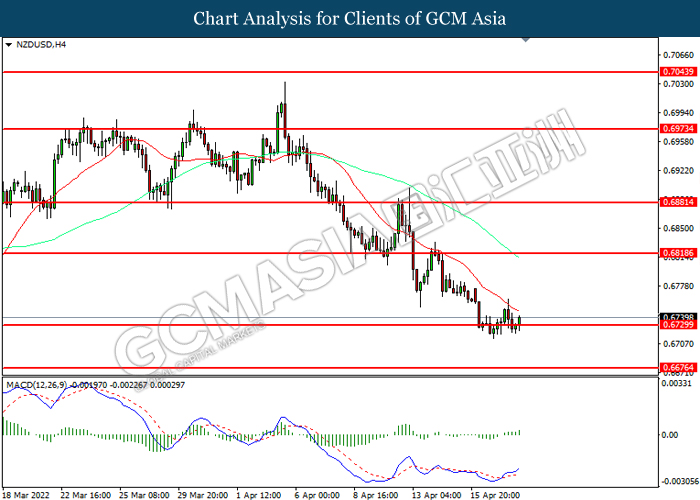

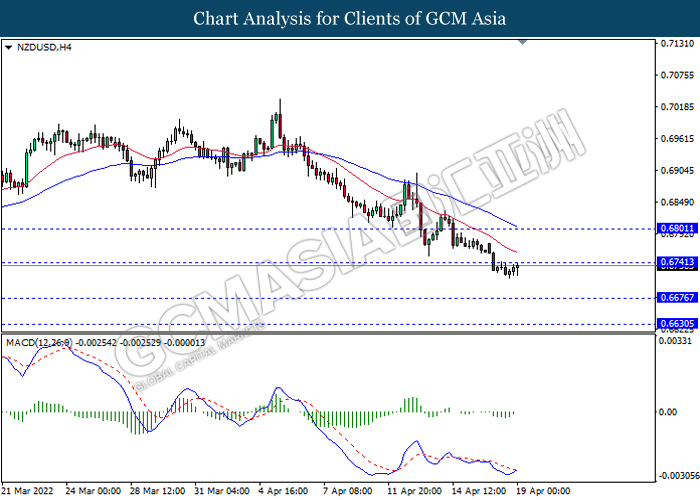

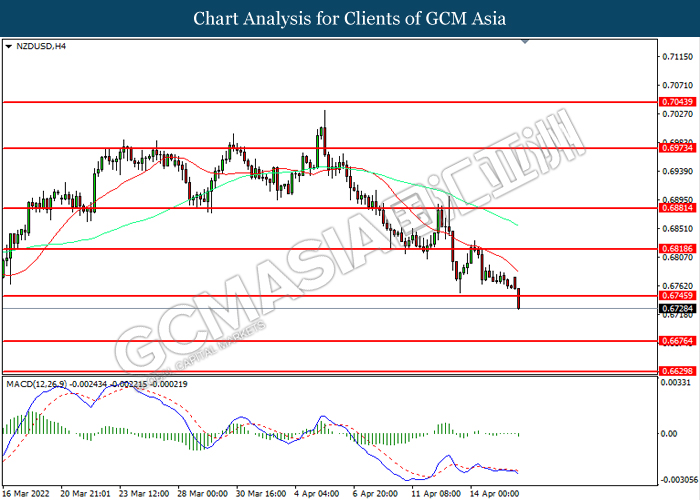

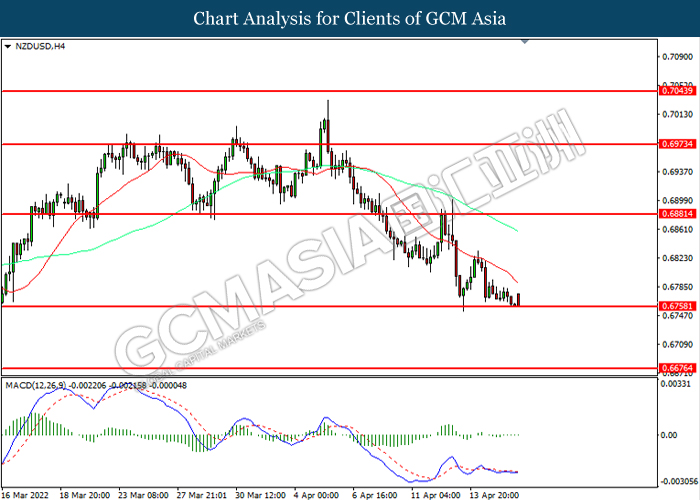

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6820

Support level: 0.6535, 0.6430

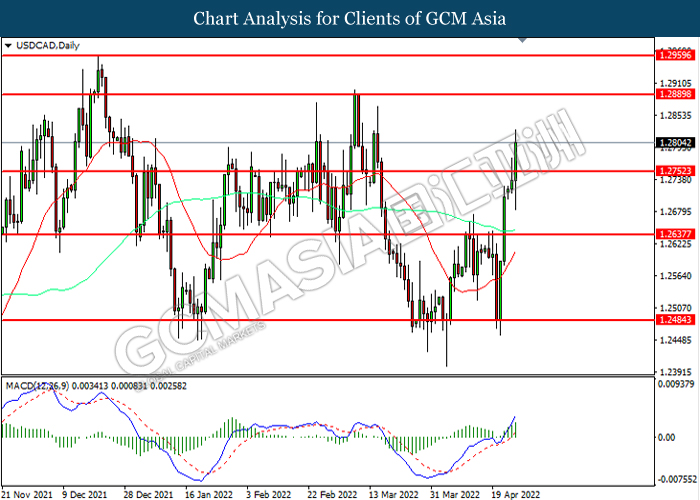

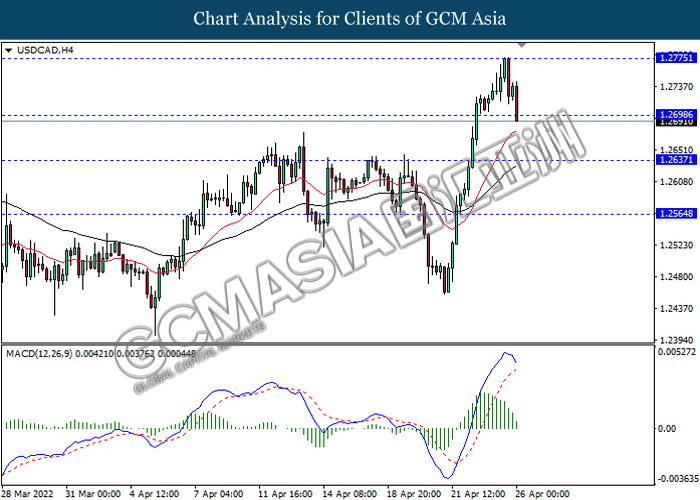

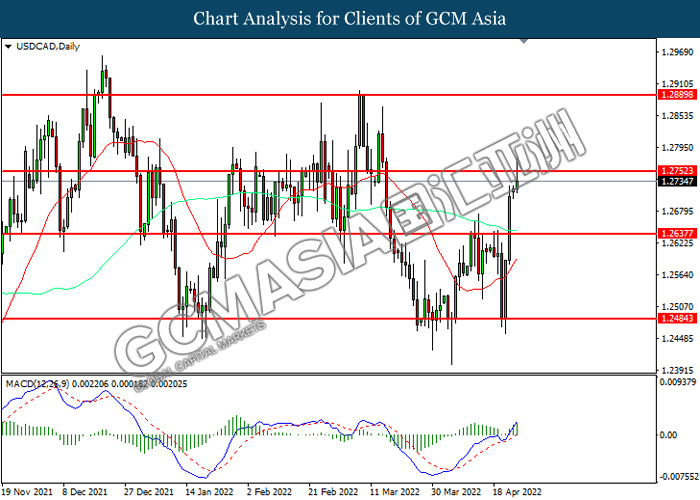

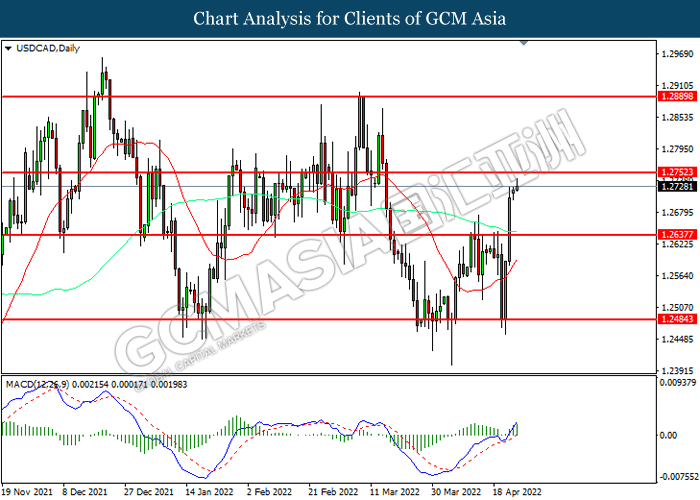

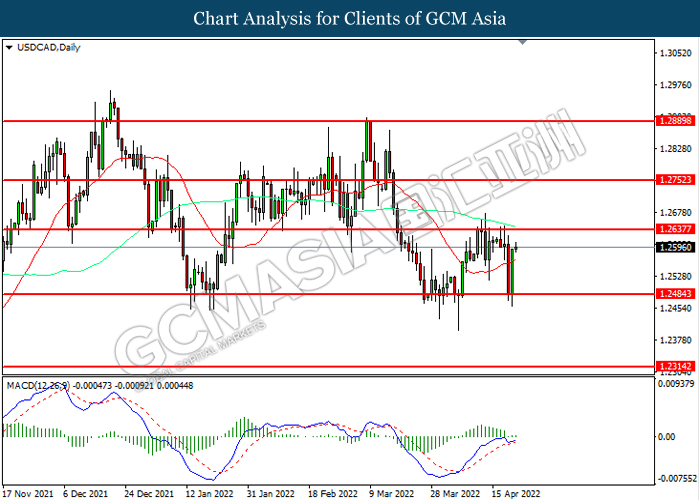

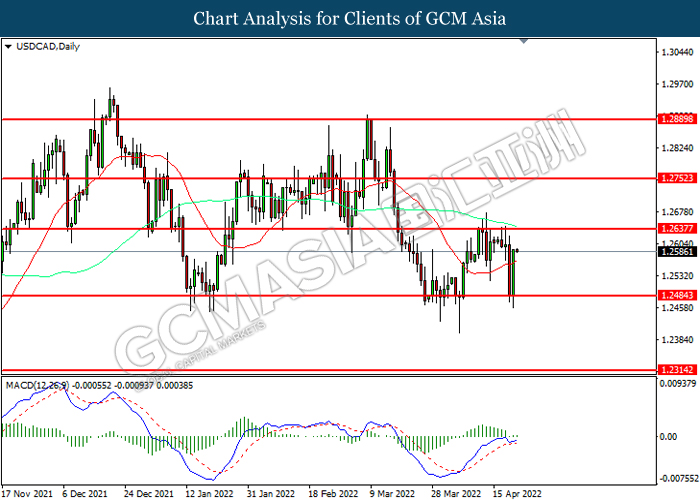

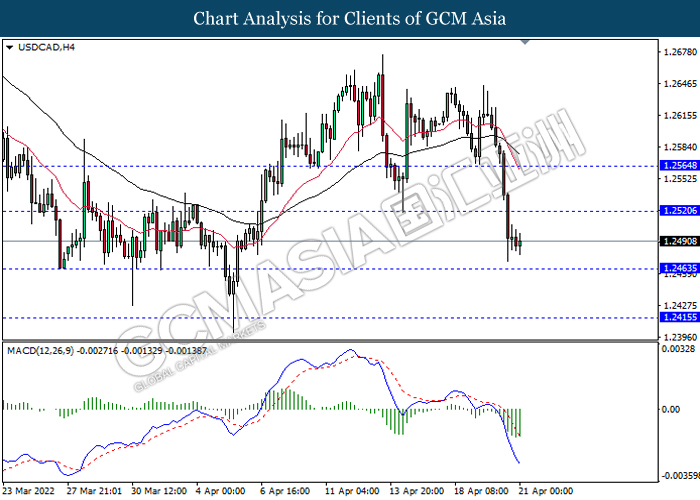

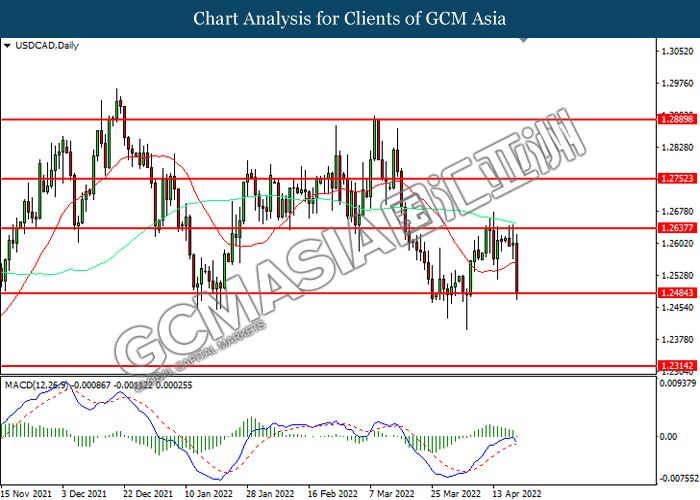

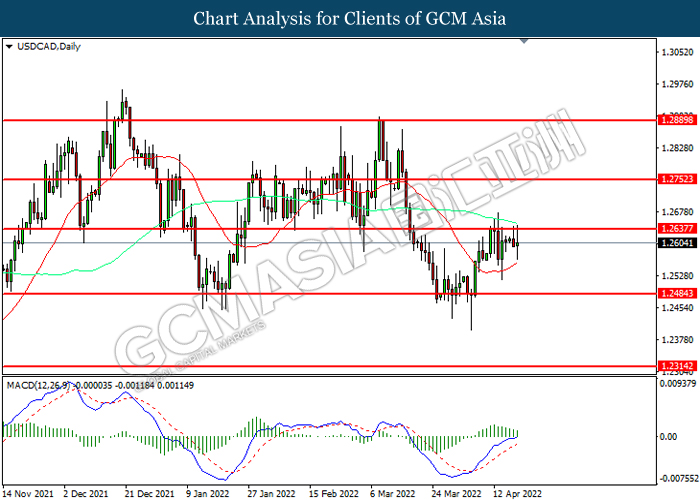

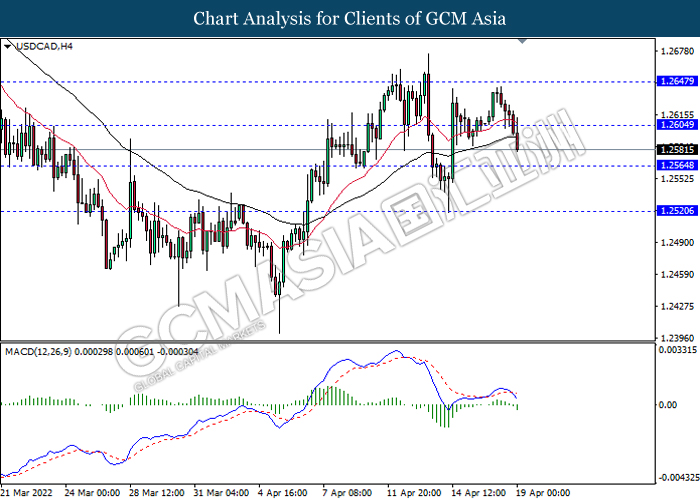

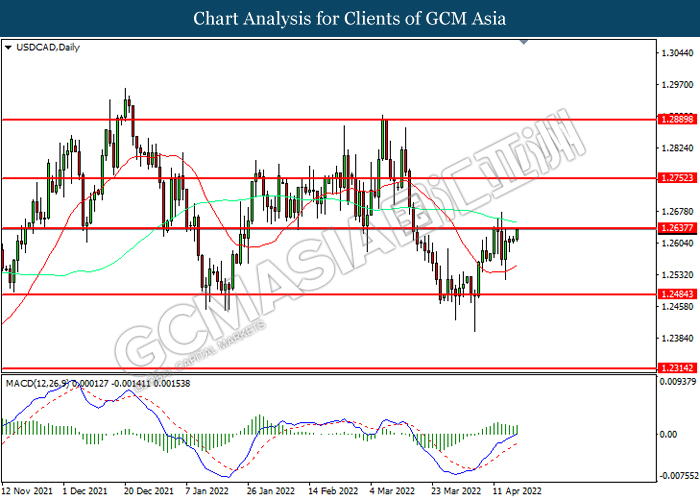

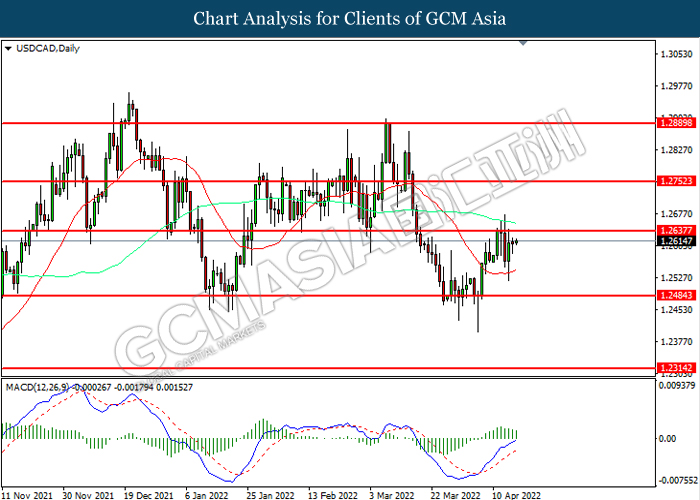

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

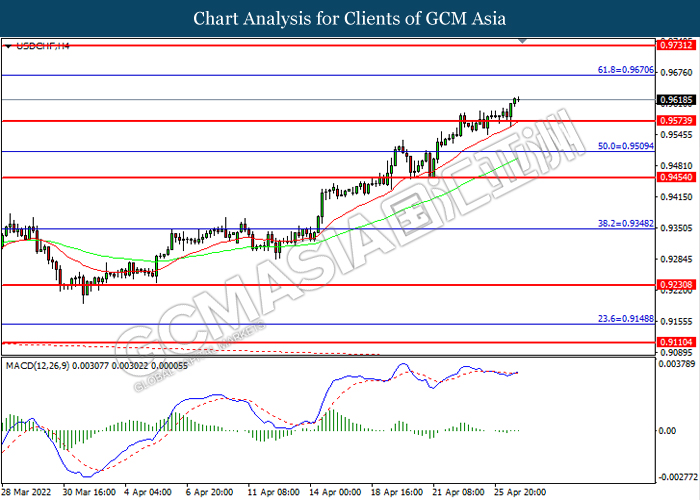

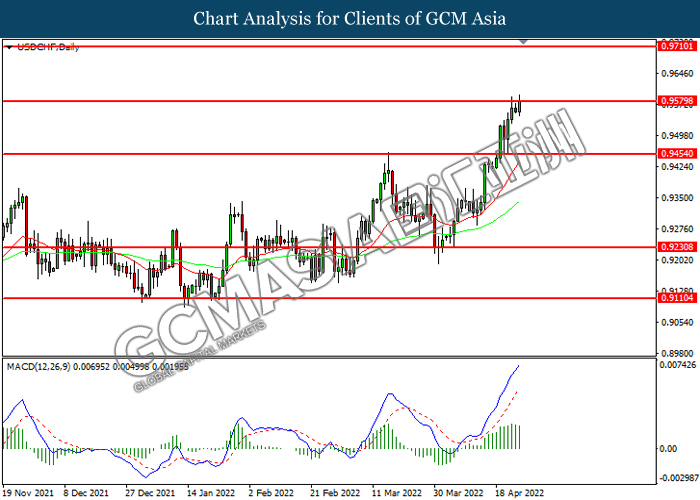

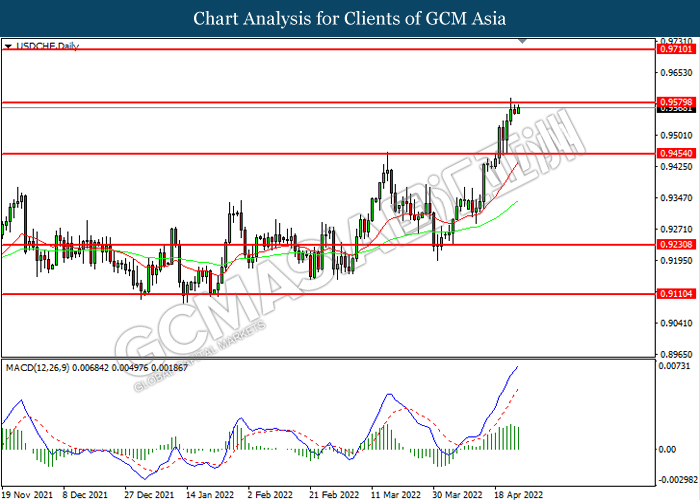

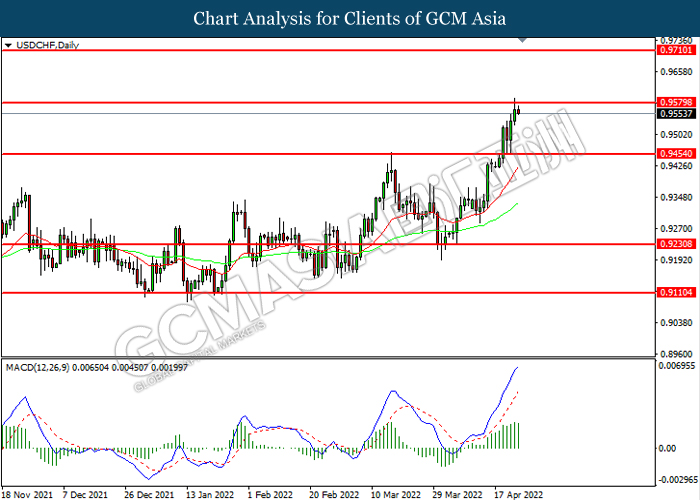

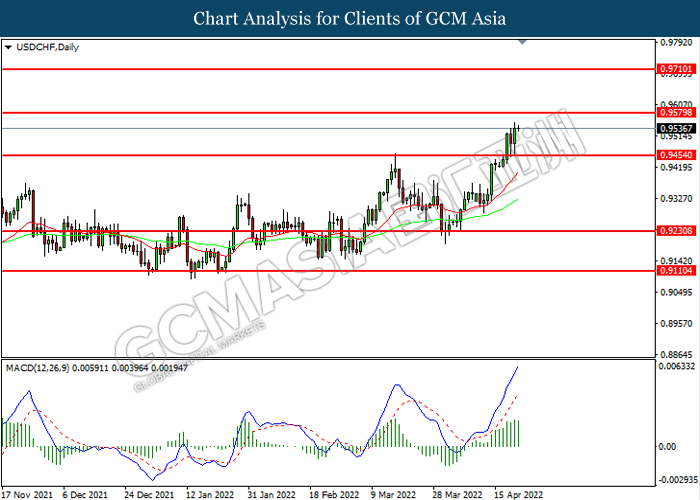

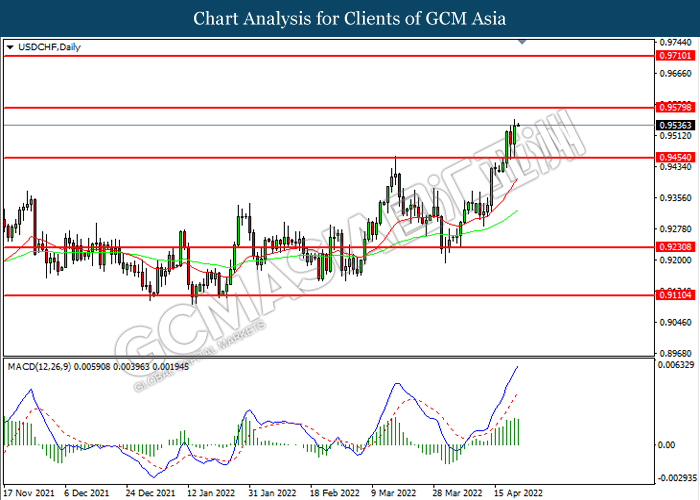

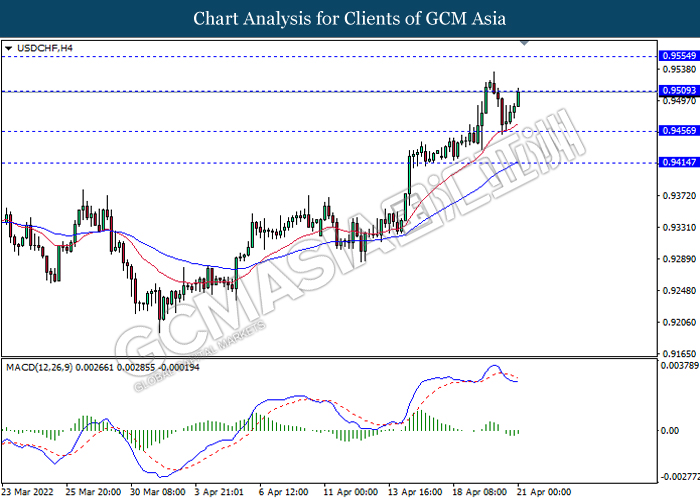

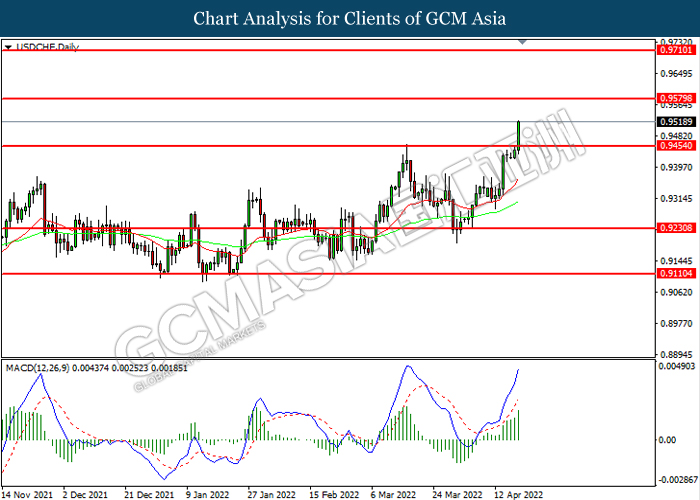

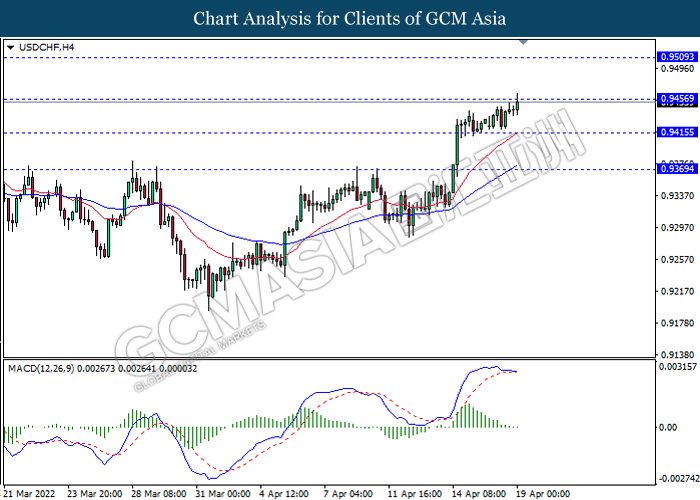

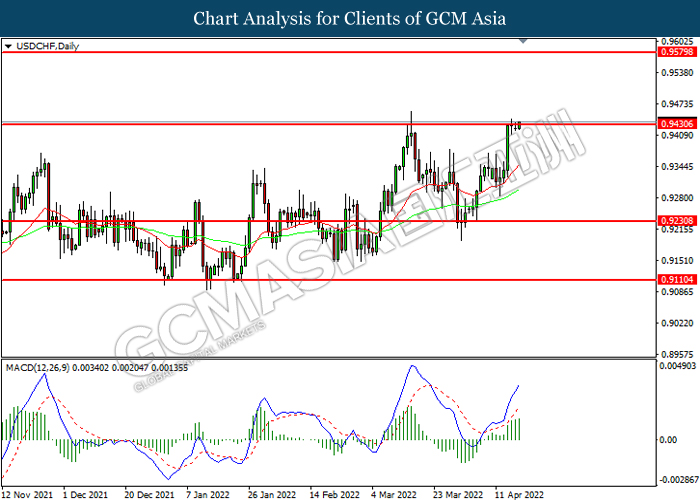

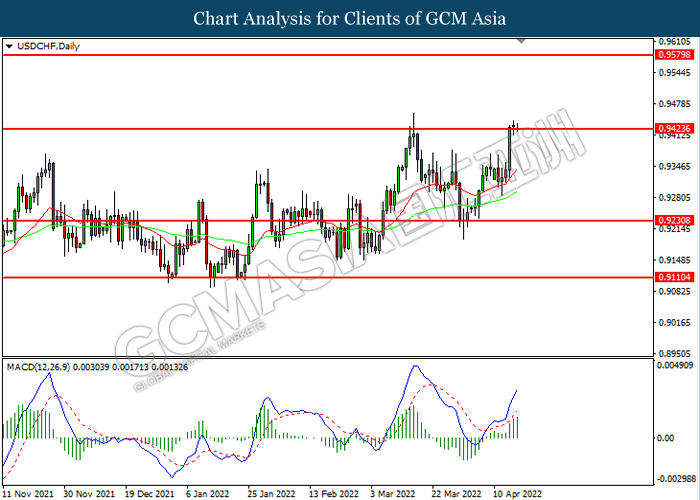

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. Nonetheless, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9670, 0.9730

Support level: 0.9575, 0.9510

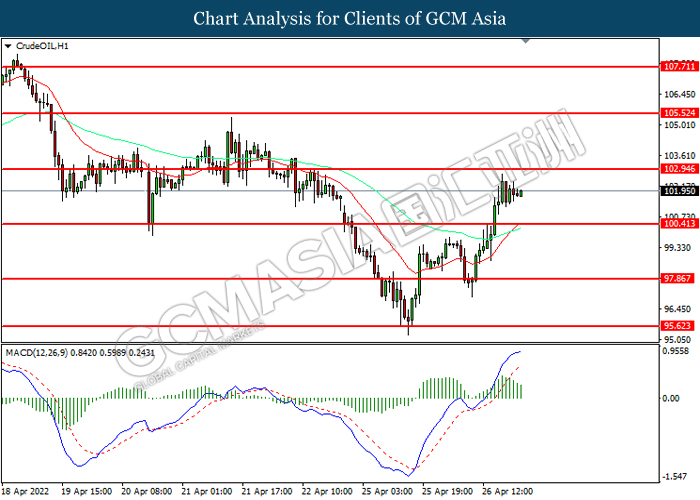

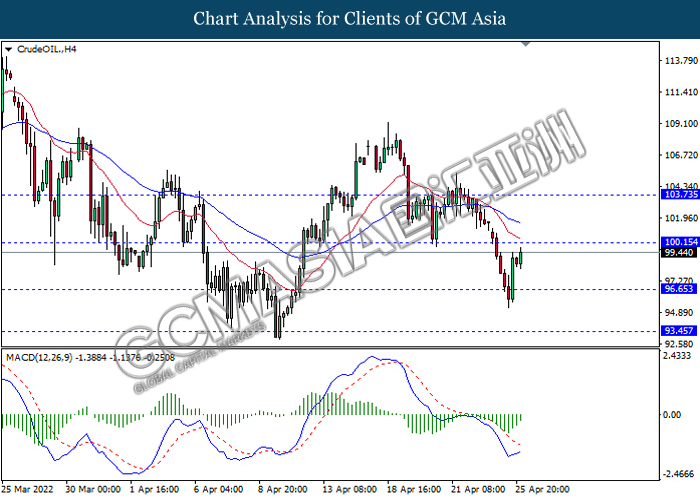

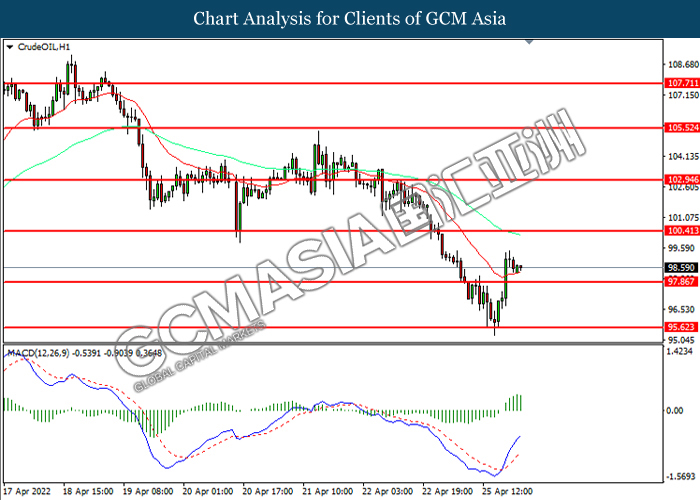

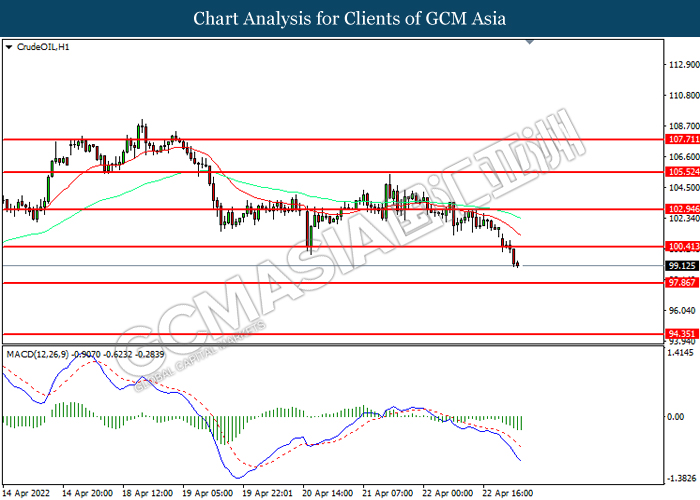

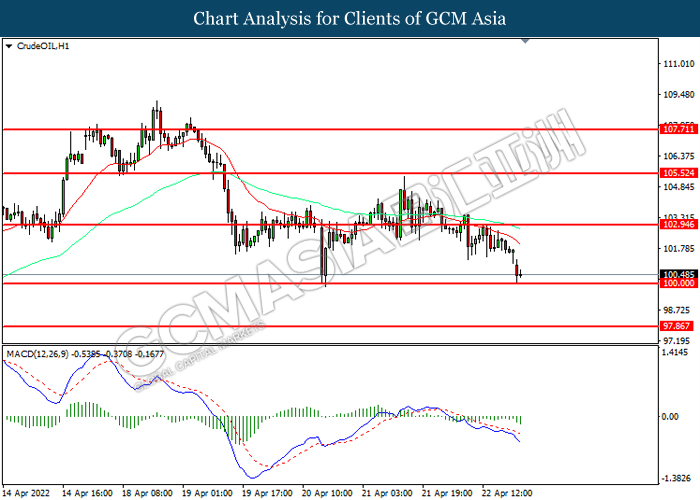

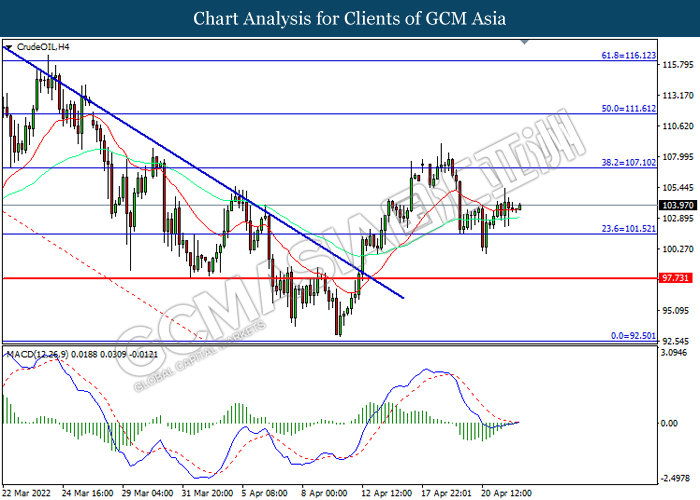

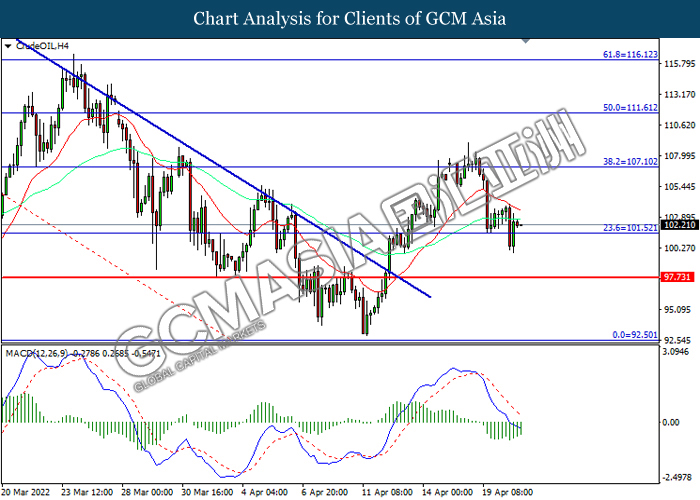

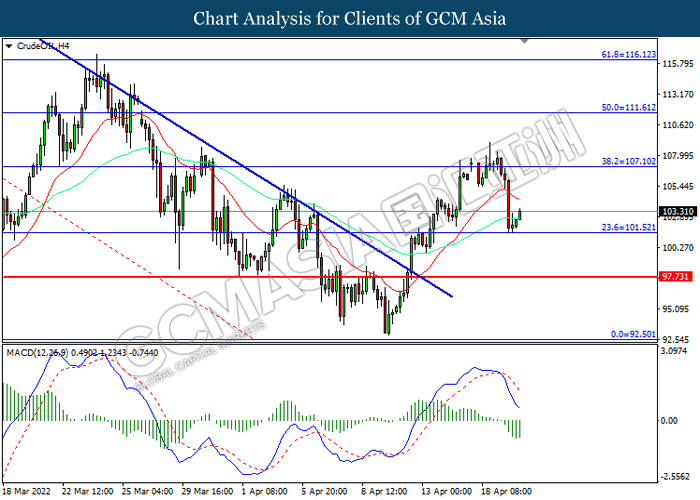

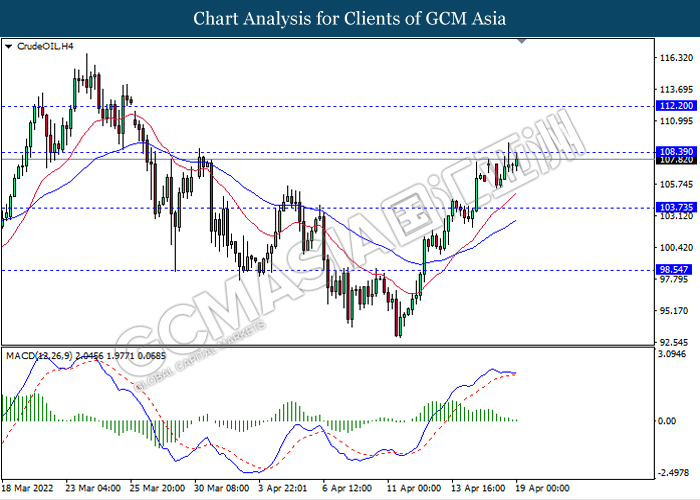

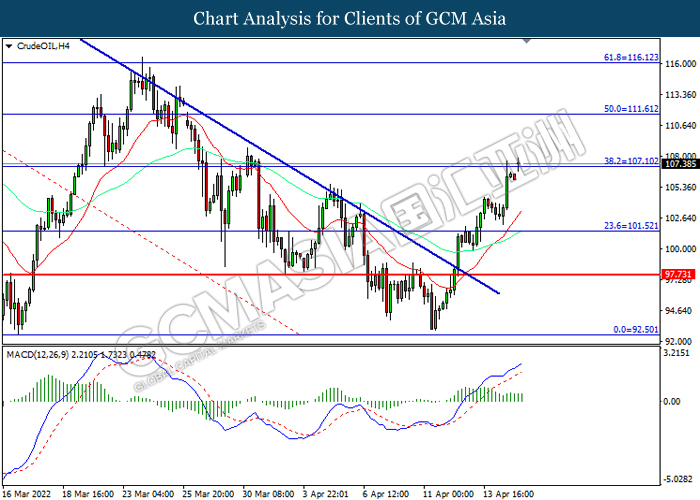

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 102.95, 105.50

Support level: 100.40, 97.85

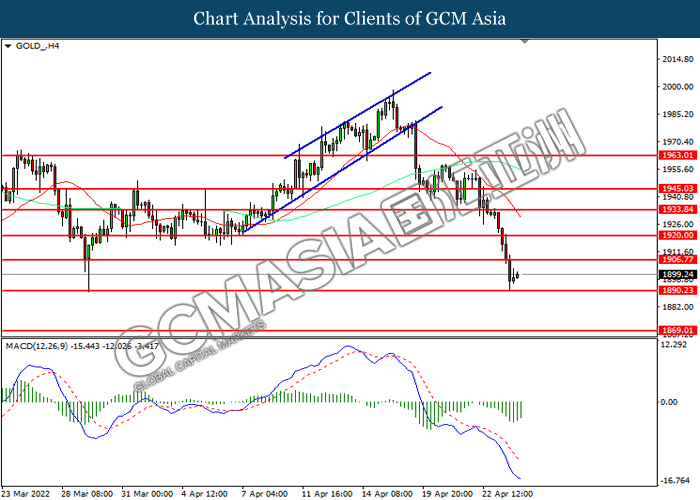

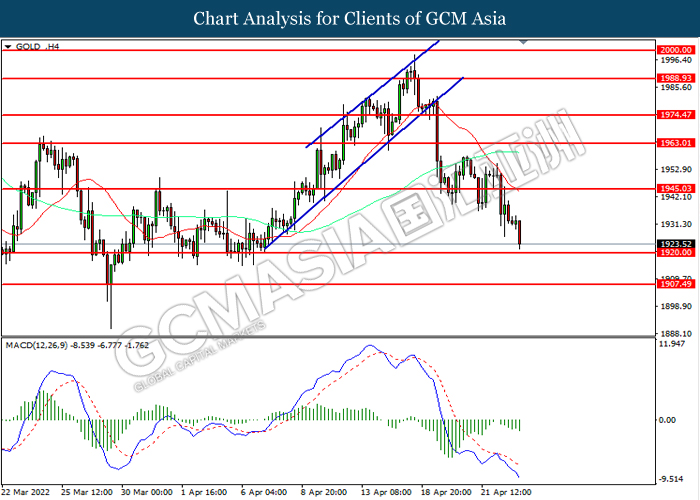

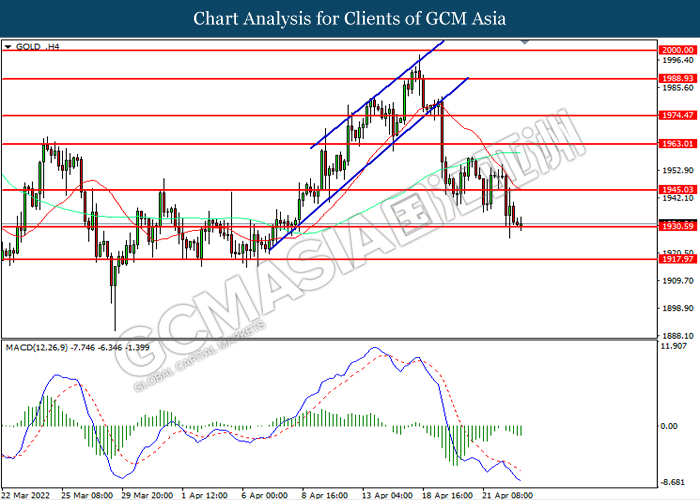

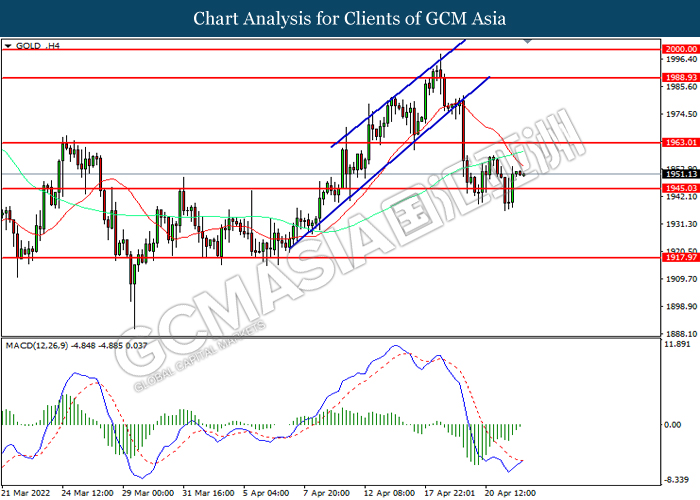

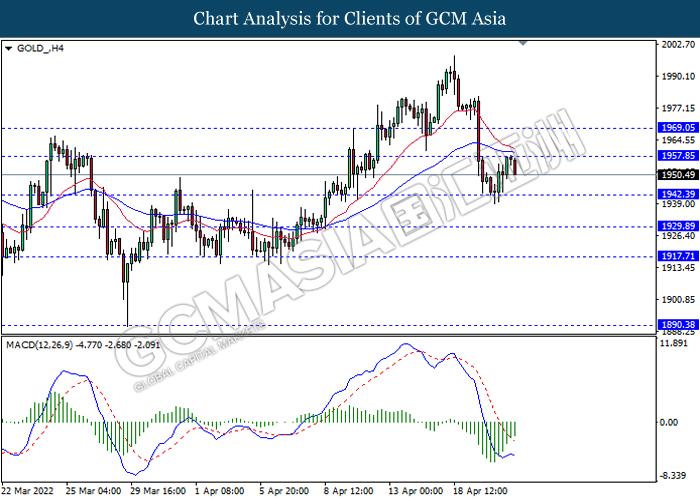

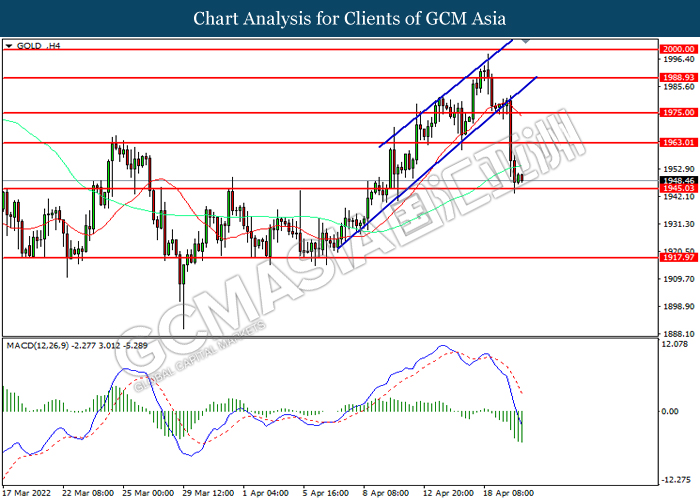

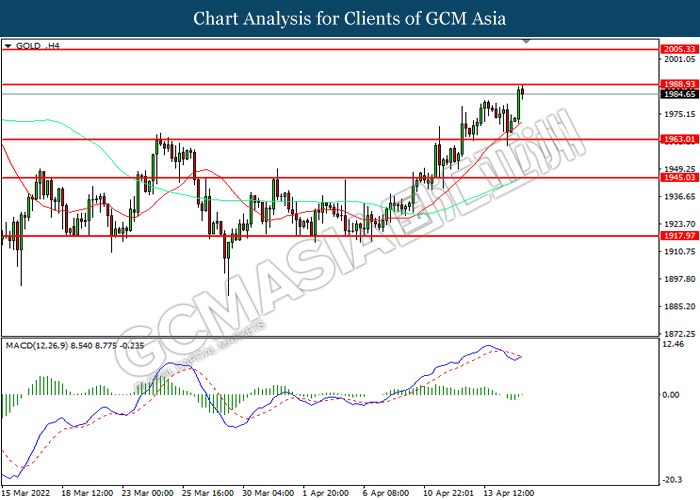

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1920.00, 1945.05

Support level: 1890.25, 1871.00

260422 Afternoon Session Analysis

26 April 2022 Afternoon Session Analysis

Australia Dollar remained bearish amid stagflationary risk.

AUDUSD rebounded from its recent low since yesterday. Nonetheless, the overall trend of the pair remained bearish amid the backdrop of rising tensions between Russia-Ukraine. According to Reuters, a senior International Monetary Fund (IMF) officially appeared a warning on Tuesday, which claimed that the Asian region faces a “stagflationary” outlook, citing the Ukraine war, spike in commodity costs and a slowdown in China as creating significant uncertainty. As China was the one of the largest trading partner for Australia, the negative economic progression in China would drag down the market optimism toward economic momentum in Australia region, prompting investors to selloff Australia Dollar. Besides, the AUDUSD pairing receive further pressure following the China Covid-19 fears. China’s capital of Beijing warned over the weekend that the Covid-19 virus had spread undetected in the city for a week, and that more cases would be found with investigation. It stoked a shift market sentiment toward other currencies which having better prospects such as US Dollar, spurring further bearish momentum on the pair. As of writing, AUDUSD edge up by 0.55% to 0.7217.

In commodities market, crude oil price appreciated by 1.17% to $99.69 per barrel as of writing after falling sharply the prior session on worries that continued COVID-19 lockdowns in China would eat into demand. On the other hand, gold price appreciated by 0.44% to 1904.40 per troy ounces as of writing following the ease of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.60% | 0.60% | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 107.2 | 108 | |

| 22:00 | USD – New Home Sales (Mar) | 772K | 765K |

Technical Analysis

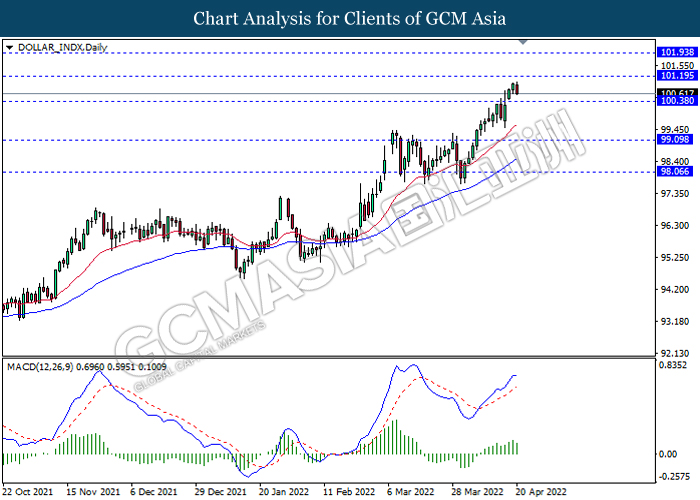

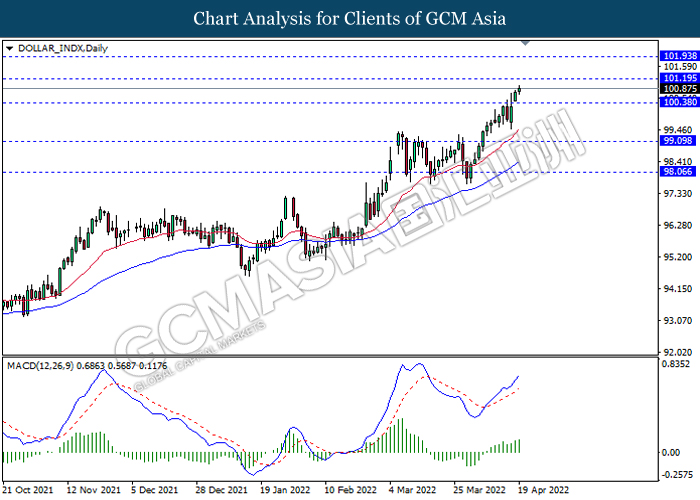

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.95, 102.60

Support level: 101.20, 100.40

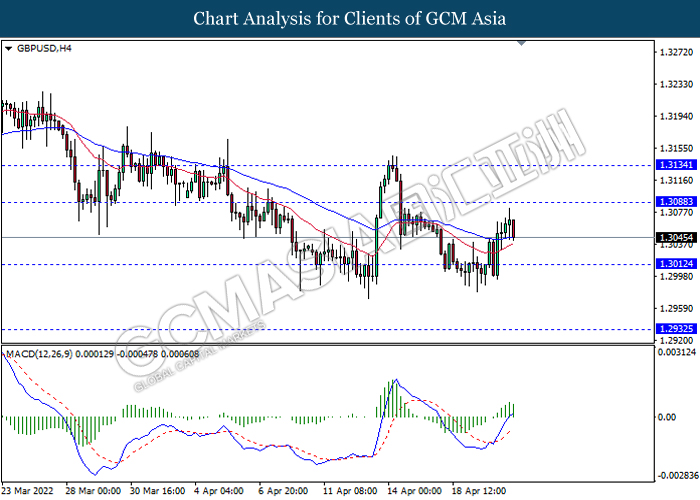

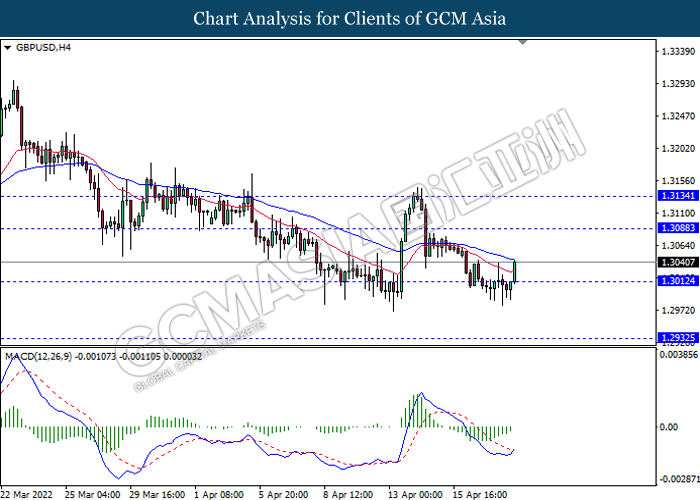

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2780, 1.2845

Support level: 1.2695, 1.2625

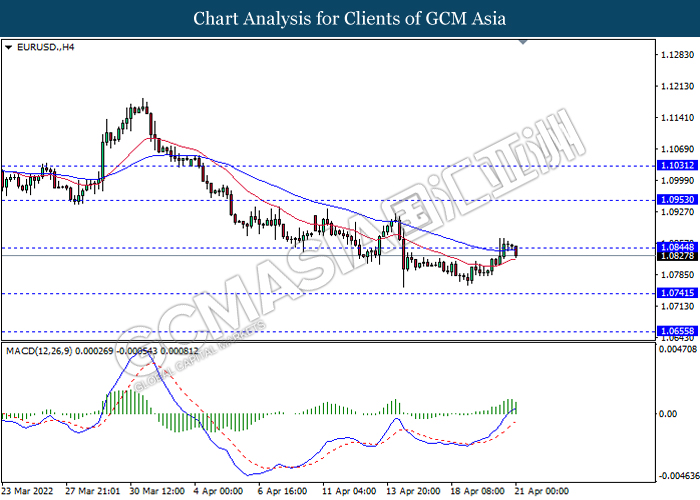

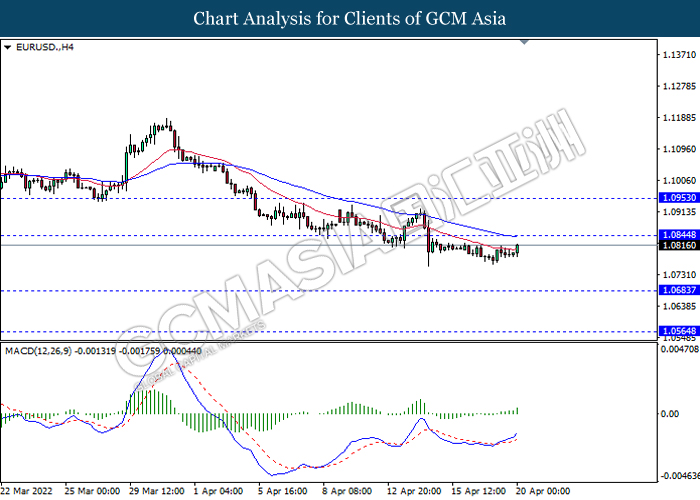

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0845

Support level: 1.0715, 1.0655

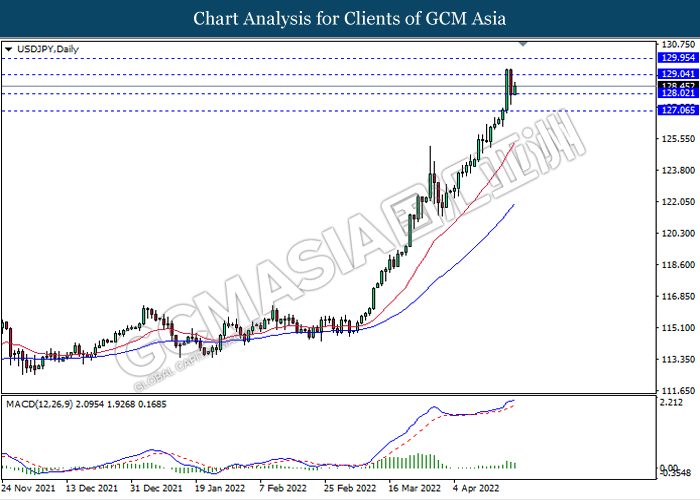

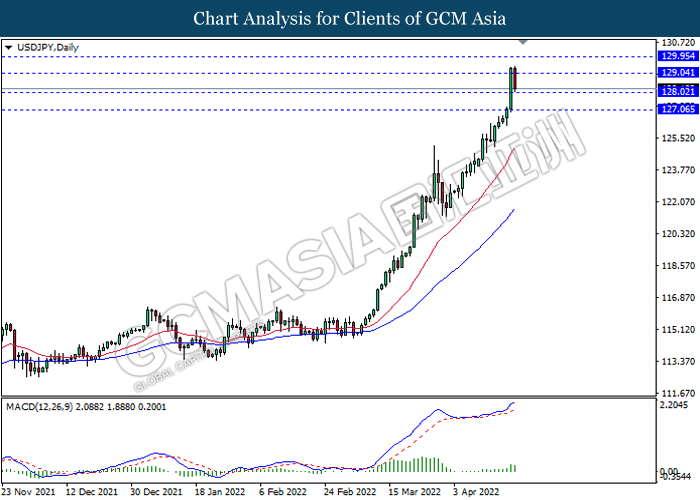

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 128.00, 129.05

Support level: 127.05, 126.10

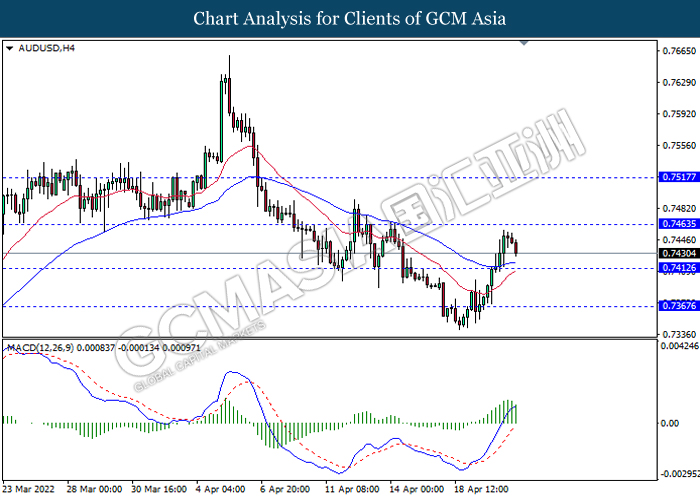

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7235, 0.7300

Support level: 0.7160, 0.7105

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6675, 0.6740

Support level: 0.6630, 0.6590

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2700, 1.2775

Support level: 1.2635, 1.2565

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9605, 0.9640

Support level: 0.9555, 0.9510

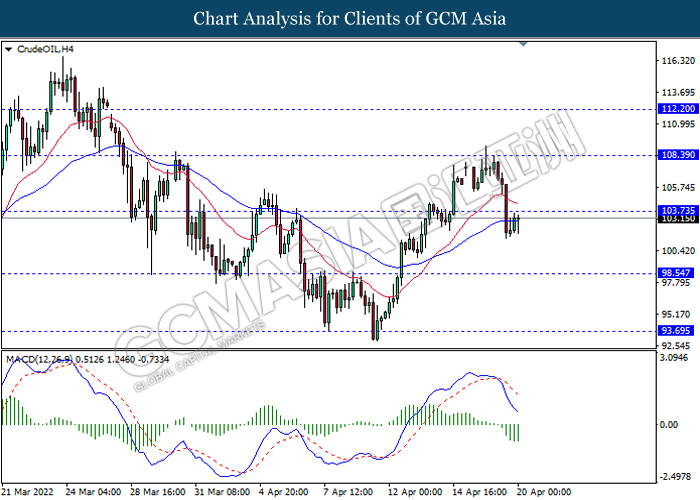

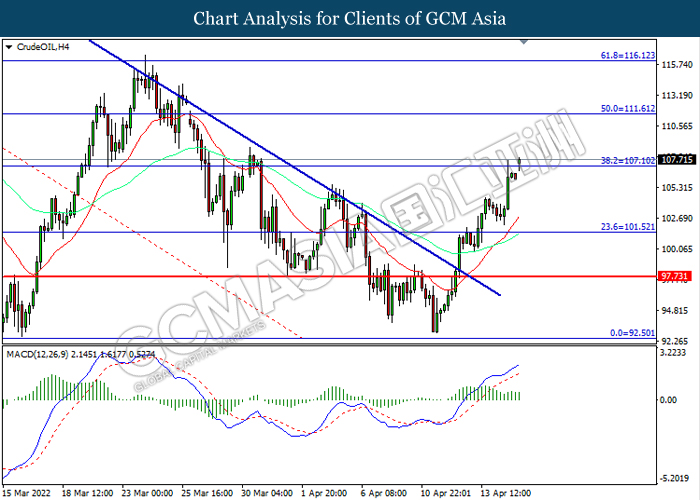

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 100.15, 103.75

Support level: 96.65, 93.45

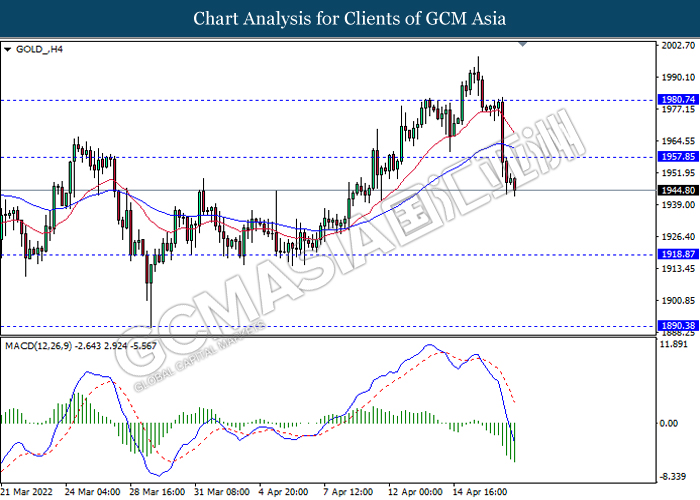

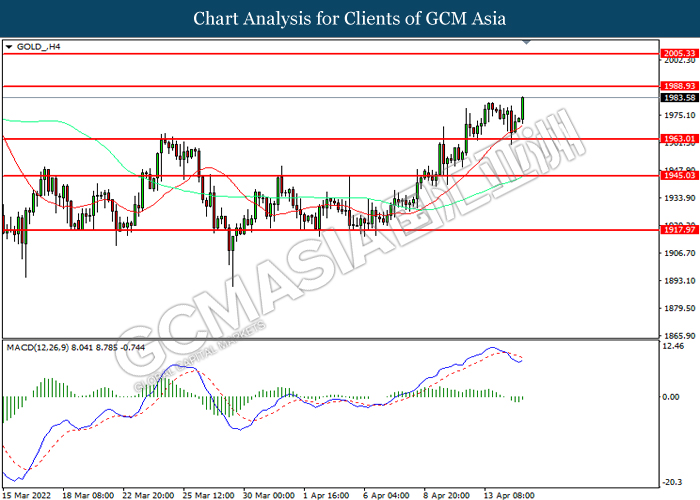

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1905.15, 1917.70

Support level: 1890.40, 1878.25

260422 Morning Session Analysis

26 April 2022 Morning Session Analysis

US Dollar surged as risk-off mood in market.

The Dollar Index which traded against a basket of six major currencies surged amid diminishing risk appetite in the global financial market on renewed concerns about rate hike expectation from Fed and the implementation of lockdown from China, which prompting investors to shift their portfolio toward safe-haven Dollar. The global equity market received significant bearish momentum yesterday while the European stocks as well as the Chinese stock market slid to one-month low. Besides, the US Dollar extend its gains following the Federal Reserve unleashed numerous hawkish tones toward the economic progression in the United States region. Market participants currently expected the Federal Reserve to increase the interest rate by 50 basis point during the next monetary policy meeting. Nonetheless, investors would continue to scrutinize the latest updates with regards of the crucial economic data today to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.51% to 101.74.

In the commodities market, the crude oil price depreciated by 0.02% to $98.59 per barrel as of writing. The oil market edged lower as the implementation of lockdown policy from China continue to weigh down the appeal for this black-commodity. On the other hand, the gold price depreciated by 0.02% to $1899.85 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.60% | 0.60% | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 107.2 | 108 | |

| 22:00 | USD – New Home Sales (Mar) | 772K | 765K |

Technical Analysis

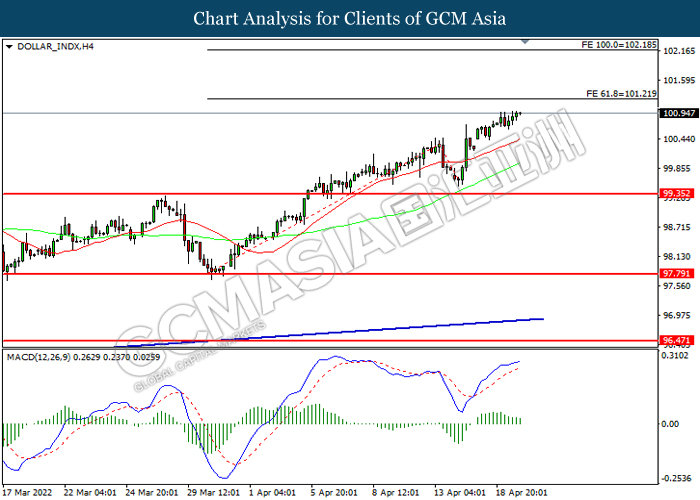

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.20, 103.75

Support level: 101.20, 99.35

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2800, 1.2995

Support level: 1.2610, 1.2470

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0805, 1.0905

Support level: 1.0690, 1.0550

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7280, 0.7360

Support level: 0.7135, 0.6985

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6705, 0.6820

Support level: 0.6605, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2750, 1.2890

Support level: 1.2635, 1.2485

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 100.40, 102.95

Support level: 97.85, 95.60

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1906.80, 1920.00

Support level: 1890.25, 1869.00

250422 Afternoon Session Analysis

25 April 2022 Afternoon Session Analysis

Pound slumped as negative economic data.

Pound Sterling slumped significantly over the backdrop of a string of bearish economic data. According to Office for National Statistics, UK Retail Sales for last month notched down significantly from the previous reading of -0.5% to -1.4%, missing the market forecast at -0.3%. Meanwhile, UK Composite Purchasing Managers; Index (PMI) declined from the preliminary reading of 60.9 to 57.6, worse than the market forecast at 59.7. Besides, the UK Manufacturing Purchasing Managers Index (PMI) and UK Services Purchasing Managers Index (PMI) came in at 55.3 and 58.3, which both fared worse than market expectation respectively at 59.0 and 60.0. Such worse-than-expectation economic data indicated that the economic recovery in the United Kingdom remained negative as the spiking numbers of inflation risk continue to weigh down the consumer spending and economic momentum. Nonetheless, as for now investors would continue to scrutinize the latest updates with regards of the monetary policy decision from Bank of England to receive further trading signal. As of writing, GBP/USD depreciated by 0.32% to 1.2795.

In the commodities market, the crude oil price slumped 2.55% to $99.80 per barrel as of writing following the Chinese authorities extend lockdown policy in order to combat the spiking number of Covid-19 cases in China. On the other hand, the gold price depreciated by 0.31% to 1925.20 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Apr) | 90.8 | 89.1 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 101.20, 102.20

Support level: 99.25, 97.80

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2800. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2995, 1.3200

Support level: 1.2800, 1.2585

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7280, 0.7360

Support level: 0.7135, 0.6985

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6705, 0.6820

Support level: 0.6600, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2750, 1.2890

Support level: 1.2635, 1.2485

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H1: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 100.40, 102.95

Support level: 97.85, 94.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1945.05, 1963.00

Support level: 1920.00, 1907.50

250422 Morning Session Analysis

25 April 2022 Morning Session Analysis

Rising yield, spurring bullish momentum on US Dollar.

The Dollar Index which traded against a basket of six major currencies extend its gains following the 5-year Treasury yield hit 3% following the Federal Reserve Chairman Jerome Powell unleashed his hawkish tone. According to CNBC, Fed Chair Jerome Powell claimed on International Monetary Fund (IMF) meeting that taming inflation risk is absolutely important. Meanwhile, he also reiterated that the Fed would likely to increase the interest rate by 50 basis point during the Fed’s May monetary policy meeting. Despite the suggestion of a 50-basis-point rate hike was aligned with market expectations, Powell’s comments still prompted the US Treasury yields surged significantly. Currently, investors have become increasingly concerned about potential threats on economic growth that could come from rising inflation and contractionary monetary policy. As of writing, the Dollar Index appreciated by 0.03% to 101.15.

In the commodities market, the crude oil price depreciated by 1.03% to $101.36 per barrel as of writing. The oil market edged lower as concerns upon the economic growth continue to weigh down the appeal for the crude oil demand. On the other hand, the gold price slumped 0.02% to $1932.05 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Apr) | 90.8 | 89.1 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 101.20, 102.20

Support level: 99.25, 97.80

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2800. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2995, 1.3200

Support level: 1.2800, 1.2585

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7280, 0.7360

Support level: 0.7135, 0.6985

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6705, 0.6820

Support level: 0.6615, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2750, 1.2890

Support level: 1.2635, 1.2485

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout the support level.

Resistance level: 102.95, 105.50

Support level: 100.00, 97.85

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1945.05, 1963.00

Support level: 1930.60, 1918.00

220422 Afternoon Session Analysis

22 April 2022 Afternoon Session Analysis

Euro slumped following ECB unleashed dovish tone.

The Euro extends its losses over the backdrop of the dovish tone from European Central Bank yesterday. According to Reuters, European Central Bank President Christine Lagarde claimed that the ECB may need to downgrade its growth outlook further amid the rising tensions between Russia-Ukraine continue to dial down the market optimism toward the economic progression in the European region. The Money Markets, which had eased rate hike expectation following the ECB meeting, were now pricing in a more than 20 basis-point (bps) rate hike by July and nearly 80 basis point of rate hike by year-end. On the other hand, the New Zealand Dollar slumped following the release of bearish economic data. According to Statistics, New Zealand, the Consumer Price Index (CPI) for last quarter in New Zealand region came in at only 1.8%, worse than the market forecast at 2.0%. Lower inflation data would likely to diminish the probability of aggressive contractionary monetary policy, dragging down the appeal for the New Zealand Dollar. As of writing, EUR/USD depreciated by 0.01% while NZD/USD slumped 0.31% to 0.6720.

In the commodities market, the crude oil price slumped 1.31% to $103.40 per barrel as of writing. The crude oil price was traded lower as investors remained concerns about the spiking number of Covid-19 cases in China would likely to weigh down the demand on this black commodity. On the other hand, the gold price slumped 0.03% to $1950.65 per troy ounces as of writing amid rate hike expectation from Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

22:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Mar) | -0.30% | -0.30% | – |

| 15:30 | EUR – German Manufacturing PMI (Apr) | 56.9 | 54.4 | – |

| 16:30 | GBP – Manufacturing PMI | 55.2 | – | – |

| 16:30 | GBP – Services PMI | 62.6 | – | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Feb) | 2.50% | 2.40% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.20, 102.20

Support level: 99.25, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2995. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7355, 0.7455

Support level: 0.7270, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6715, 0.6820

Support level: 0.6630, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout the support level.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1963.00, 1975.00

Support level: 1945.05, 1917.95

220422 Morning Session Analysis

22 April 2022 Morning Session Analysis

US Dollar surged as Fed unleashed hawkish tone.

The Dollar Index which traded against a basket of six major currencies rebounded from one-week low following the Federal Reserve Chair Jerome Powell unleashed his hawkish tone toward the economic progression in the United States. According to Reuters, Federal Reserve Chair Jerome Powell confirmed a 50-basis point of rate hike during the monetary policy meeting next month, including consecutive rate increases in the year of 2022. Fed funds futures have started to speculate a three straight 50 basis-point interest rate hikes starting with next month’s policy meeting. With inflation running roughly three times higher than the Fed’s target, it would prompt the Fed to be tightening the monetary policy in more aggressive ways to stabilize the inflation risk. As of writing, the Dollar Index appreciated by 0.24% to 100.65.

In the commodities market, the crude oil price surged by 0.03% to $103.48 per barrel as of writing. The oil market edged higher as market participants remained concerns that the European Union (EU) would likely to implement sanction on Russian oil supply. On the other hand, the gold price depreciated by 0.02% to $1951.00 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

22:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Mar) | -0.30% | -0.30% | – |

| 15:30 | EUR – German Manufacturing PMI (Apr) | 56.9 | 54.4 | – |

| 16:30 | GBP – Manufacturing PMI | 55.2 | – | – |

| 16:30 | GBP – Services PMI | 62.6 | – | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Feb) | 2.50% | 2.40% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 101.20, 102.20

Support level: 99.25, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2995. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7455, 0.7525

Support level: 0.7355, 0.7270

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6820, 0.6880

Support level: 0.6715, 0.6630

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1963.00, 1975.00

Support level: 1945.05, 1917.95

210422 Afternoon Session Analysis

21 April 2022 Afternoon Session Analysis

Euro rallied amid pre-election debate on French.

The Euro extends its gains on yesterday following the French President Emmanuel Macron was found to be more convincing than far-right candidate Marine Le Pen in a pre-election debate on French television ahead of Sunday’s presidential runoff vote, according to Reuters. The snap survey by Elabe for BFM TV found that 59% of polled viewers found Macron more convincing than Le Pen. Polls of voting intentions for the April 24 election estimate that Macron will win with around 55.5% of the vote. In the year of 2017, Macron beat Le Pen with 66.1% of the vote.” Investors remained optimism that if Emmanuel Macron re-elected to become French President, it would more likely to reduce further geopolitical risk in France while spurring positive prospect on the economic progression in European region. As of writing, EURUSD edged down by 0.20% to 1.0828.

In commodities market, crude oil price appreciated by 0.91% to 103.12 per barrel as of writing after being rocked earlier in the week by supply losses from Libya and a worrying outlook for demand as the International Monetary Fund cut its global growth forecasts. On the other hand, gold price depreciated by 0.13% to 1953.05 per troy ounces as of writing amid the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Mar) | 7.50% | 7.50% | – |

| 20:30 | USD – Initial Jobless Claims | 185K | 175K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Apr) | 27.4 | 20 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.20, 101.95

Support level: 100.40, 99.10

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3135

Support level: 1.3010, 1.2930

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0845, 1.0955

Support level: 1.0740, 1.0655

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.05

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7465, 0.7515

Support level: 0.7410, 0.7365

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6800, 0.6870

Support level: 0.6740, 0.6675

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2520, 1.2565

Support level: 1.2465, 1.2415

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9510, 0.9555

Support level: 0.9455, 0.9415

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 108.40

Support level: 98.55, 93.70

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1957.85, 1969.05

Support level: 1942.40, 1929.90

210422 Morning Session Analysis

21 April 2022 Morning Session Analysis

US Dollar slumped amid bearish economic data.

The Dollar Index which traded against a basket of six major currencies retreat from its recent high over the backdrop of bearish economic data, which dialled down the market optimism toward the economic progression in United States. According to National Association of Realtor, US Existing Home Sales notched down from the previous reading of 5.93M to 5.77M, missing the market forecast at 5.80M. The data dropped to the lowest level in nearly two years in March as the house prices raced to a record high, and economist expected the data would decline further with higher mortgage rate in future. Besides, the US Dollar extend its losses following the 10-year Treasury yield retreats from 3-year high, dragging down the appeal for the US Dollar. The yield on the benchmark 10-year Treasury note dipped more than 7 basis point to 2.844%. Though, the overall long-term trend for the US Dollar still remained bullish amid rate hike expectation from Fed during the FOMC meeting in May. As of writing, the Dollar Index depreciated by 0.61% to 100.34.

In the commodities market, the crude oil price surged 0.03% to $103.10 per barrel during the early Asian trading hours following the bullish inventory data was released. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -8.020M, better than the market forecast at 2.471M. On the other hand, the gold price surged 0.03% to $1955.65 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Mar) | 7.50% | 7.50% | – |

| 20:30 | USD – Initial Jobless Claims | 185K | 175K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Apr) | 27.4 | 20 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 101.20, 102.20

Support level: 100.25, 99.35

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 129.45, 132.30

Support level: 127.65 , 126.00

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7380, 0.7270

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6820, 0.6880

Support level: 0.6730, 0.6675

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it breakout the support level.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1963.00, 1975.00

Support level: 1945.05, 1917.95

200422 Afternoon Session Analysis

20 April 2022 Afternoon Session Analysis

Australia Dollar surged following the support from People’s Bank of China.

AUDUSD rebounded from its recent low following People’s Bank of China (PBOC) provide support to boost up economy, which spurred bullish momentum on the pair. According to Reuters, People’s Bank of China appeared a statement on Wednesday, which urged financial institutions to step up support for the contact-intensive service sector and small firms impacted by COVID-19. Besides, the People’s Bank of China also called for flexible adjustments to mortgage payment plans for home buyers impacted by COVID outbreaks, and vowed to keep property sector financing stable and orderly. The moves of PBOC would likely to bring positive prospects toward economic momentum in China by increasing citizens’ purchasing power and reducing companies’ cost. As China was one of the largest trading partner for Australia, it dialed up the market optimism toward economic progression in Australia region, prompting investors to purchase Australia Dollar. As of writing, AUDUSD edged up by 0.47% to 0.7405.

In commodities market, crude oil price appreciated by 0.83% to $102.88 per barrel as of writing. According to Bloomberg, the industry-funded American Petroleum Institute reported that US crude stockpiles declined by about 4.5 million barrels last week, according to people familiar with the data. On the other hand, gold price slumped by 0.62% to $1946.65 per troy ounces as of writing amid the backdrop of the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.80% | – | – |

| 22:00 | USD – Existing Home Sales (Mar) | 6.02M | 5.80M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 9.382M | 0.863M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.20, 101.95

Support level: 100.40, 99.10

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3090, 1.3135

Support level: 1.3010, 1.2930

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0845, 1.0955

Support level: 1.0685, 1.0565

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.05

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7410, 0.7465

Support level: 0.7365, 0.7300

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6800, 0.6870

Support level: 0.6740, 0.6675

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2605, 1.2645

Support level: 1.2565, 1.2520

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9555, 0.9605

Support level: 0.9510, 0.9455

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 108.40

Support level: 98.55, 93.70

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1957.85, 1980.75

Support level: 1918.85, 1890.40

200422 Morning Session Analysis

20 April 2022 Morning Session Analysis

US Dollar jumped, buoyed by rate hike expectation.

The Dollar Index which traded against a basket of six major currencies extend its gains yesterday amid the rate hike expectation from Federal Reserve continue to spur bullish momentum on the US Dollar. As for now, the US Benchmark 10-year Treasury yields hit 2.93% on Tuesday, the highest since December 2018. Chicago Federal Reserve Bank President Charles Evans also reiterated that he would support the Federal Reserve to increase their interest rate by 50 basis-point during the next monetary policy meeting in order to combat the high inflation rate. Besides, St Louis Federal Reserve Bank President James Bullard also said that the Fed would likely to increase their interest rates to 3.5% by the end of the year while reiterating that he did not rule out the possibility of a 75-basis point rate hike in future. Tightening monetary policy would likely to reduce the money circulation in the US Dollar market, which sparkling the appeal for the currency. As of writing, the Dollar Index appreciated by 0.21% to 101.00.

In the commodities market, the crude oil price surged 0.80% to $103.20 during the early Asian trading session over the backdrop of bullish inventory data. According to American Petroleum Institute, US API Weekly Crude Oil Stock came in at -4.496M, less than the market forecast at 2.533M. On the other hand, the gold price depreciated by 0.08% to $1947.98 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.80% | – | – |

| 22:00 | USD – Existing Home Sales (Mar) | 6.02M | 5.80M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 9.382M | 0.863M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 101.20, 102.20

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 129.85, 132.70

Support level: 128.05, 126.00

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7530, 0.7660

Support level: 0.7380, 0.7270

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6820, 0.6880

Support level: 0.6730, 0.6675

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1963.00, 1975.00

Support level: 1945.05, 1917.95

190422 Afternoon Session Analysis

19 April 2022 Afternoon Session Analysis

Euro eased following Russia invasion of Ukraine.

Euro edged down since yesterday amid the backdrop of rising tensions of Russia-Ukraine conflict. According to Reuters, Ukrainian authorities appeared a fact that missiles struck Lviv early on Monday and explosions rocked other cities as Russian forces kept up their bombardments after claiming near full control of the strategic southern port of Mariupol. Russia invasion of Ukraine would likely to disrupt the global supply chain, including commodities market, leading to the spike of commodities price such as crude oil. The surge of oil price would increase the import cost of companies in Europe region as Europe was one of the dependent on Russia oil, dialing down the market optimism toward economic progression in Europe region. Besides, the rising tension of Russia-Ukraine would likely to cause further aggressive sanction on Russia commodities, spurring further bearish momentum on Euro. As of writing, EURUSD depreciated by 0.09% to 1.0770.

In commodities market, crude oil price extend its gains by 0.46% to $108.11 per barrel as of writing over the expectation of sanctions on Russia oil from European Union. On the other hand, gold price edged down by 0.30% to $1980.50 per troy ounces following the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Mar) | 1.865M | 1.830M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 101.20, 101.95

Support level: 100.40, 99.10

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3010, 1.3090

Support level: 1.2930, 1.2845

EURUSD, H4: EURUSD was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0795, 1.0955

Support level: 1.0685, 1.0580

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 128.00, 129.05

Support level: 127.05, 126.00

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7365, 0.7410

Support level: 0.7300, 0.7235

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6740, 0.6800

Support level: 0.6675, 0.6630

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2605, 1.2645

Support level: 1.2565, 1.2520

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9455, 0.9510

Support level: 0.9415, 0.9370

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 108.40, 112.20

Support level: 103.75, 98.55

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1988.50, 2004.45

Support level: 1974.45, 1961.65

190422 Morning Session Analysis

19 April 2022 Morning Session Analysis

US Dollar surged as US Treasury yield hit two-year high.

The Dollar Index which traded against a basket of six major currencies rose to a fresh two-year high yesterday, in line with higher US Treasury yields following investors speculated for at least 50 basis point rate hike from Federal Reserve. Currently, the US Rate future markets has priced in a 96% chance of a 50-basis point rate hike during the Fed’s monetary policy meeting in next month. Besides, the benchmark 10-year US Treasury yield rose 4 basis points to 2.851%, reaching its highest level since late 2018. Besides, the US Dollar extend its gain as rising tensions between Russia-Ukraine had stoked a shift in sentiment toward the safe-haven US Dollar. According to Reuters, Russia’s missiles had continued to strike Lviv in western Ukraine. Meanwhile, explosions rocked other cities in Ukraine as Russian forces kept up their bombardments after claiming near full control of Mariupol. As of writing, the Dollar Index appreciated by 0.50% to 100.85.

In the commodities market, the crude oil price extends its gains by 0.04% to 107.89 per barrel as of writing. The oil market received further bullish momentum as escalating tensions between Russia-Ukraine had insinuated hopes upon an aggressive sanction from EU region to Russia. On the other hand, the gold price depreciated by 0.04% to $1976.80 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Mar) | 1.865M | 1.830M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 101.20, 102.20

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 128.05, 129.85

Support level: 126.00, 123.95

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7390, 0.7530

Support level: 0.7270, 0.7180

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6745, 0.6820

Support level: 0.6675, 0.6610

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9455, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 107.10. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1988.95. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1988.95, 2005.35

Support level: 1963.00, 1945.05

180422 Afternoon Session Analysis

18 April 2022 Afternoon Session Analysis

Euro slumped as rising Russian-Ukraine tensions spurred stagflation risk.

The Euro extends its losses over the backdrop of rising tensions between Russia-Ukraine, which dialling down the market optimism toward the economic progression in the European region. German economists are forecasting a recession in Europe’s largest economy if Russian oil and gas supplies were to stop, and effects could lead to significant stagflation risk in future. According to ABC news, multiple rockets struck the centre of Ukraine’s second-largest city on Sunday. Currently, the Russia-Ukraine conflict is still not easing, US Secretary of State Antony Blinken told European allies that the US believes the Russian military operations in Ukraine could last through the end of 2022. At the same time, the US and NATO had increased their shipments of the powerful weapon to Ukraine, pushing the crisis into unpredictable territory. As of writing, EUR/USD depreciated by 0.07% to $1.0798.

In the commodities market, the crude oil price appreciated by 1.25% to 108.25 per barrel as of writing. The oil market edged higher amid rising tensions in Libya had prompted the authorities to halt oil production from its EI Feel oilfield on Sunday. On the other hand, the gold price surged 0.57% to $1984.65 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day EUR Italy – Easter

All Day EUR France – Easter

All Day EUR Spain – Easter

All Day AUD Australia – Easter

All Day HKD Hong Kong – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 101.20, 102.20

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0905, 1.0975

Support level: 1.0795, 1.0690

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 128.05, 129.85

Support level: 126.00, 123.95

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7390, 0.7530

Support level: 0.7270, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6745, 0.6820

Support level: 0.6675, 0.6630

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9430, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 107.10. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout the resistance level.

Resistance level: 1988.95, 2005.35

Support level: 1963.00, 1945.05

180422 Morning Session Analysis

18 April 2022 Morning Session Analysis

US Dollar surged as rate hike expectation.

The Dollar Index which traded against a basket of six major currencies hovered at recent peak as more hawkish statement form Federal Reserve officials continue to enforce the rate hike expectation. According to Reuters, New York Fed President John Williams claimed on Thursday that a 50-basis point of rate hike in next month was a reasonable option, signaling a faster tightening monetary policy in future. Contractionary monetary policy would likely to diminish the money circulation in the currencies market, spurring bullish momentum on the US Dollar. Currently, investors will be closely monitoring remarks on Thursday by Federal Reserve. The Fed Chair Jerome Powell would speak at the spring meeting of the International Monetary Fund (IMF) on Thursday to discuss about the monetary policy decision. As of writing, the Dollar Index appreciated by 0.16% to 100.50.

In the commodities market, the crude oil price appreciated by 1.33% to $107.43 per barrel as of writing. The oil price traded higher following Shanghai reported a record number of symptomatic Covid-19 cases on Saturday and other areas across China had tightened controls in order to combat the highly transmissible Omicron variant. On the other hand, the gold price appreciated by 0.32% to $1979.78 per troy ounces as of writing amid rising tensions between Russian-Ukraine continue to insinuate risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day EUR Italy – Easter

All Day EUR France – Easter

All Day EUR Spain – Easter

All Day AUD Australia – Easter

All Day HKD Hong Kong – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.3050, 1.2995

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0910, 1.0975

Support level: 1.0805, 1.0690

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level at 128.05.

Resistance level: 128.05, 129.85

Support level: 126.00, 123.95

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7390, 0.7270

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6880, 0.6975

Support level: 0.6760, 0.6675

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.60, 116.10

Support level: 107.10, 101.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout the resistance level.

Resistance level: 1988.95, 2005.35

Support level: 1963.00, 1945.05