150422 Afternoon Session Analysis

15 April 2022 Afternoon Session Analysis

Euro eased amid the dovish tone of European Central Bank.

The Euro slumped significantly into two-year low against the US Dollar following the European Central Bank President Christine Lagarde unleashed her dovish tone toward the economic progression in EU yesterday, spurring significant selloff on Euro. According to Reuters, the European Central Bank President Christine Lagarde claimed that currently the European Central Bank was still in no rush to increase interest rates, in contrast with an aggressive contractionary monetary policy from US Federal Reserve. The ECB on Thursday concluded its latest meeting with cautious steps to unwind support to avoid economic shock to the European Union. The ECB confirmed their plan to slowly reduce the bond purchases program as well as the quantitative easing program this quarter. Meanwhile, the ECB also maintained their interest rate at 0.00%, aligned with the market forecast. As of writing, EUR/USD depreciated by 0.05% to 1.0819.

In commodities market, crude oil price appreciated by 2.17% to $106.51 per barrel as of writing amid the European Union might phase in a ban on Russian oil imports. Besides, gold price depreciated by 0.61% to $1972.50 per troy ounces as of writing following the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Good Friday

All Day EUR European Union – Good Friday

All Day GBP United Kingdom – Good Friday

All Day AUD Australia – Good Friday

All Day CAD Canada – Good Friday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

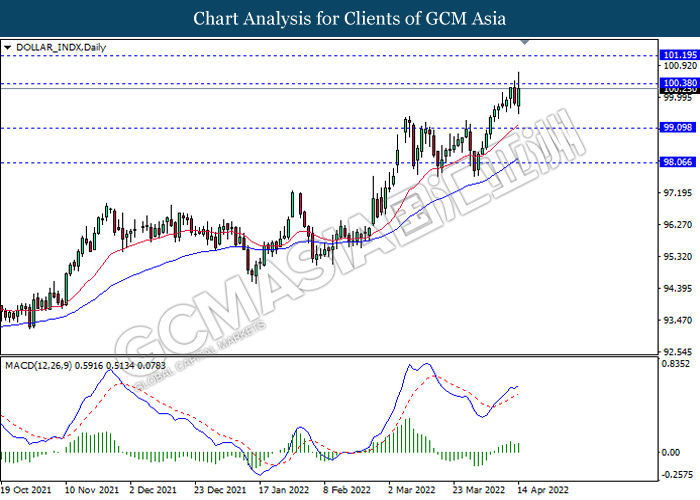

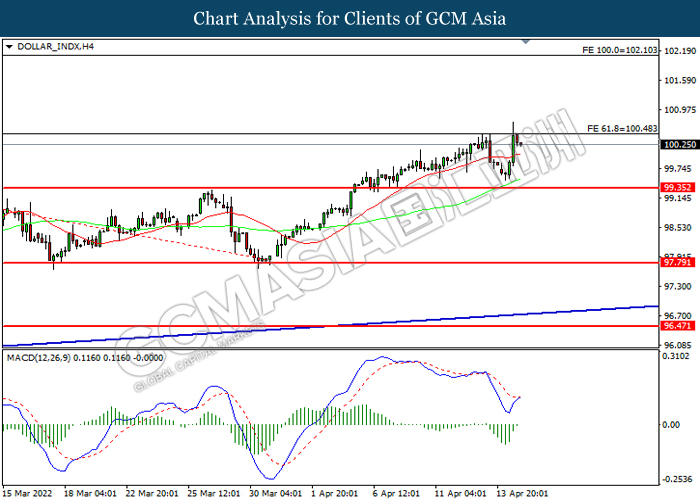

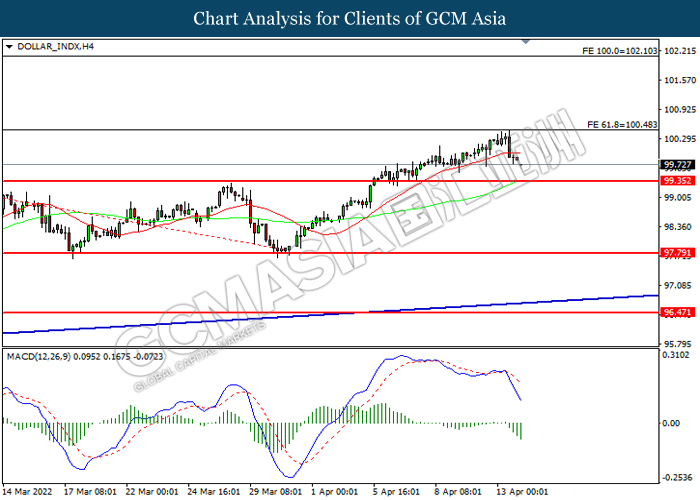

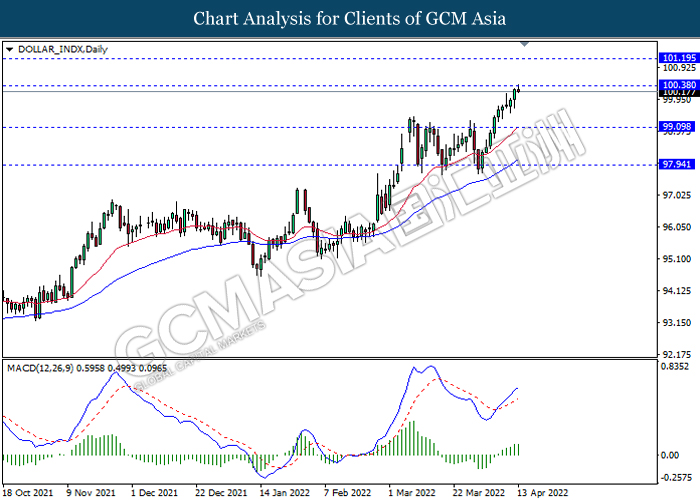

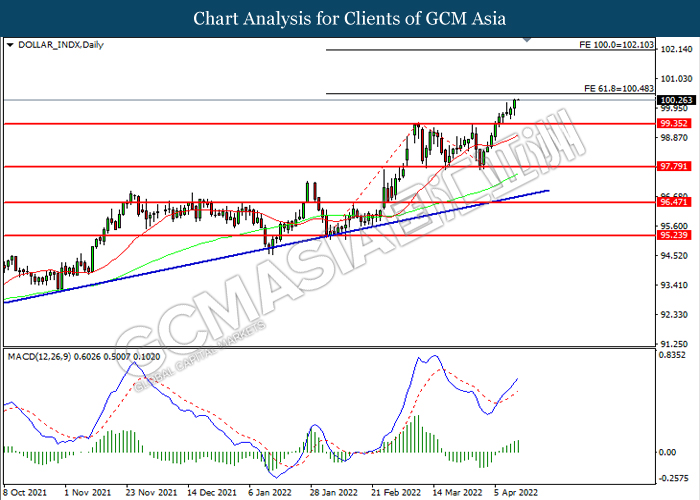

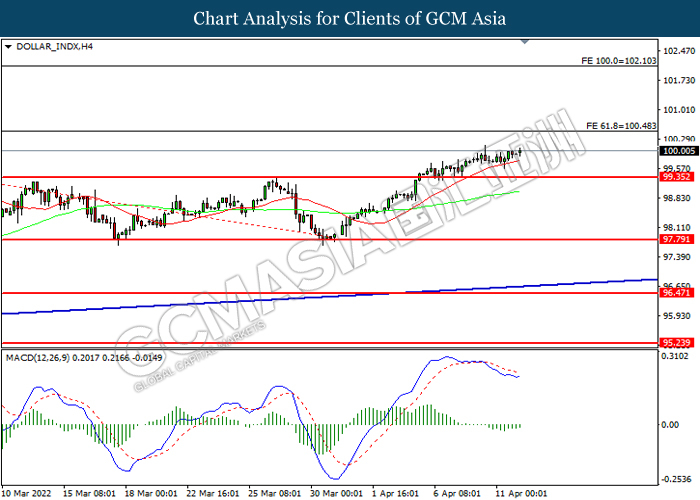

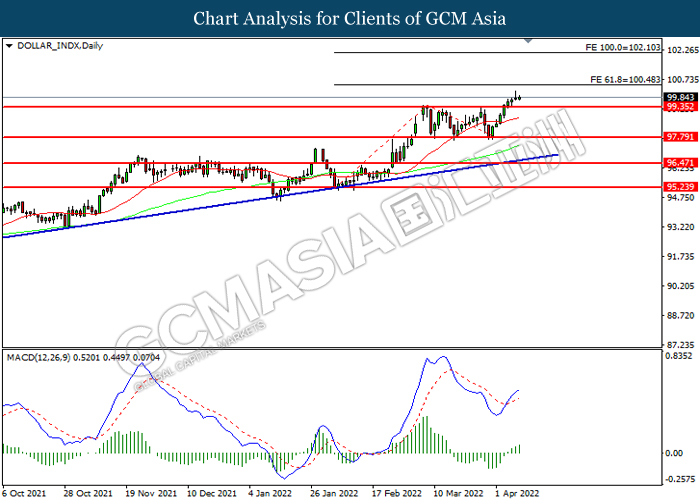

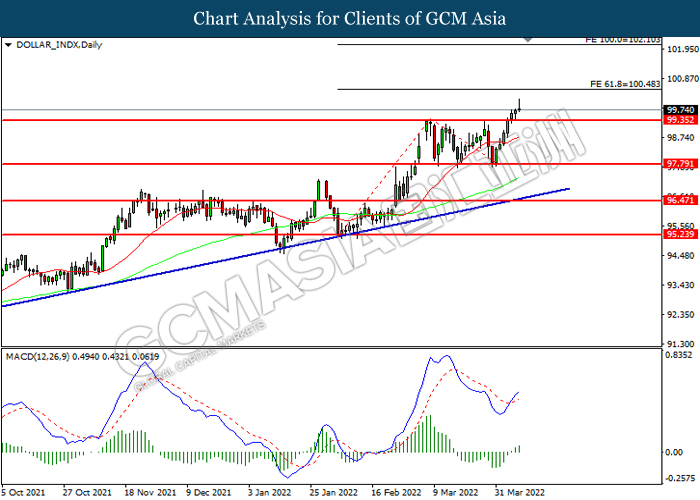

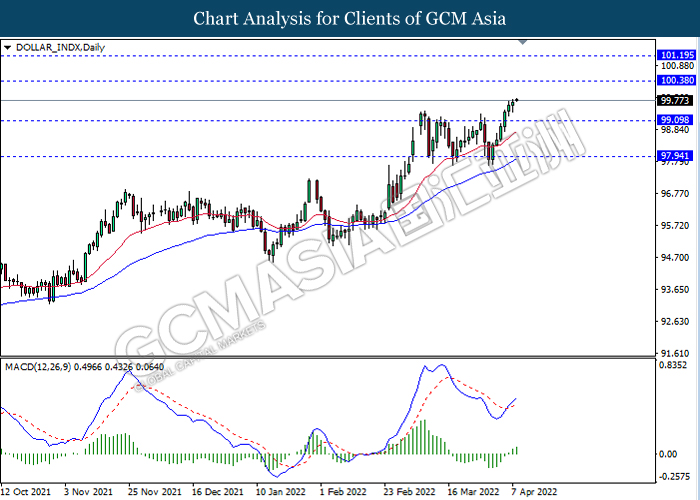

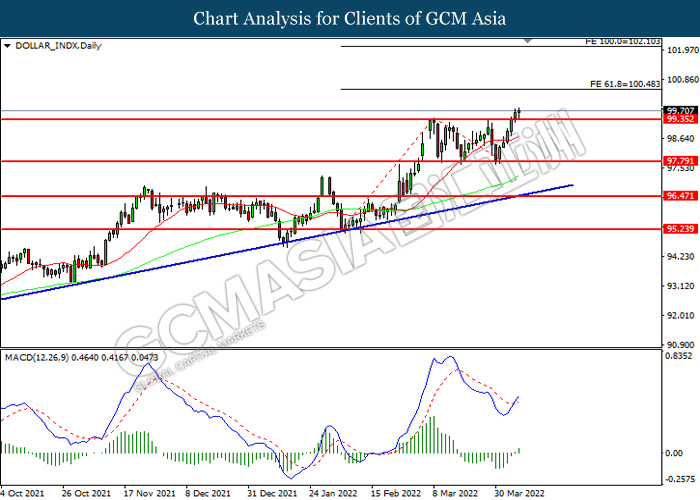

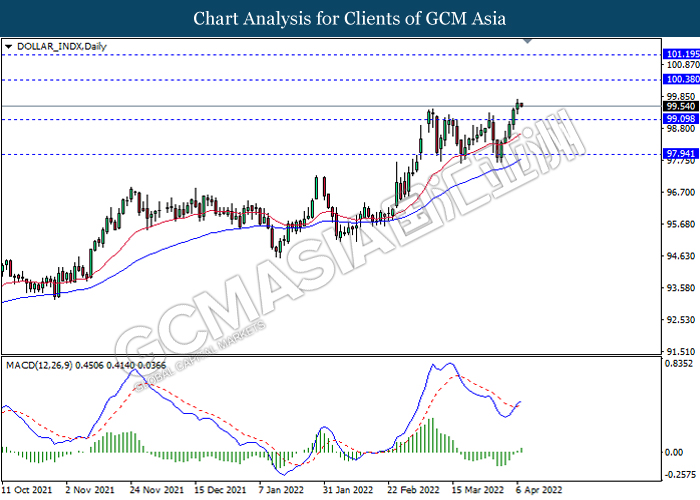

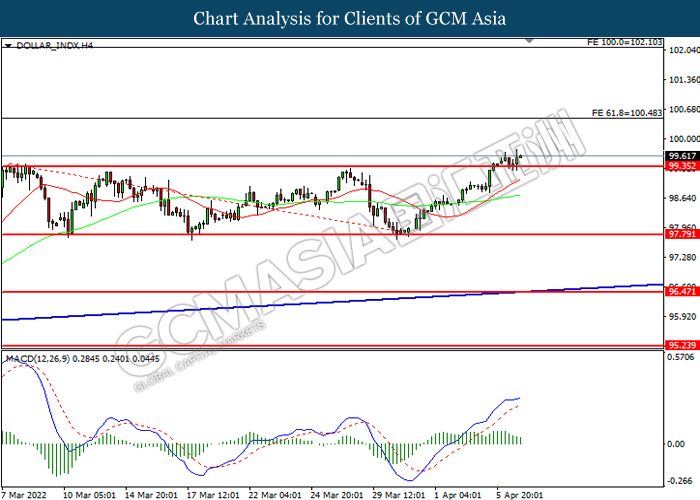

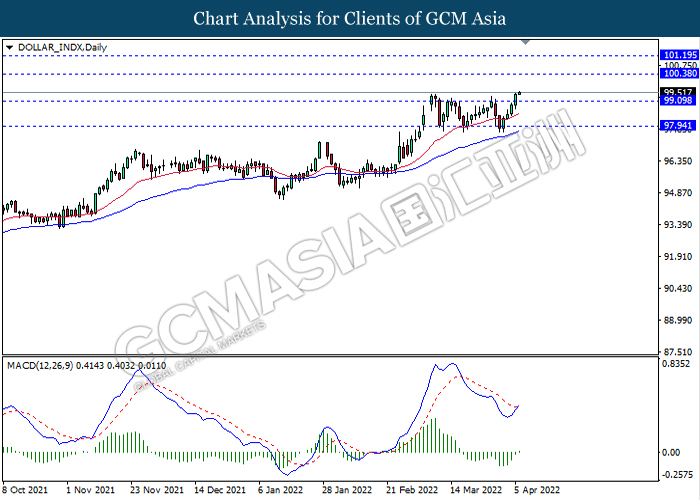

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 100.40, 101.20

Support level: 99.10, 98.05

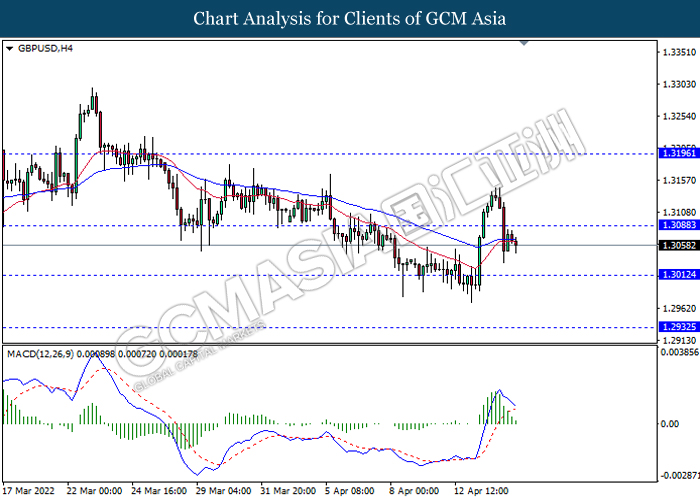

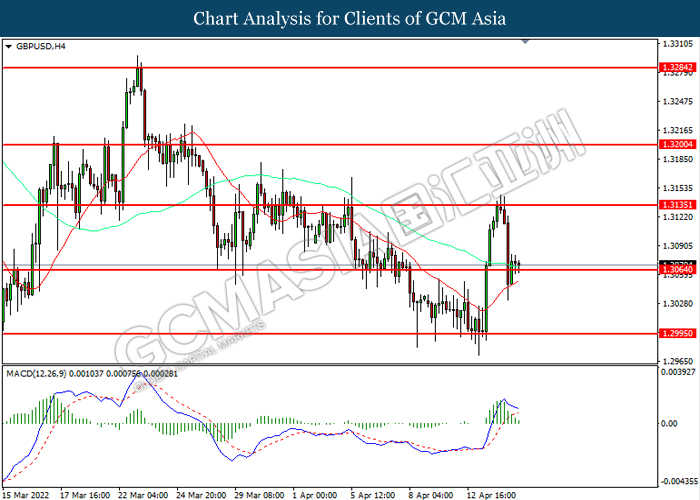

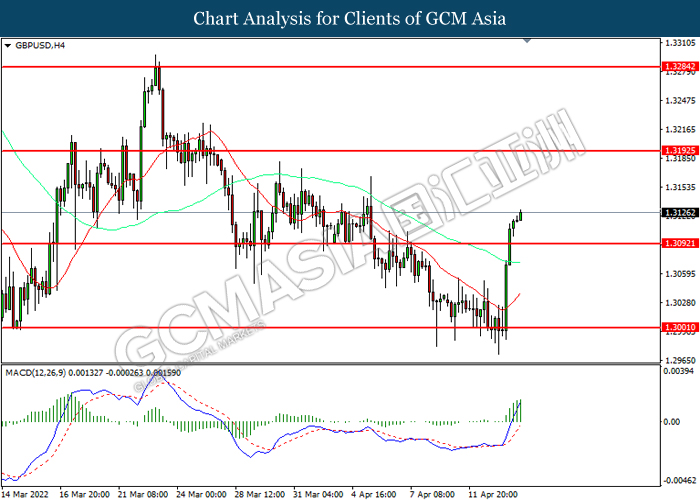

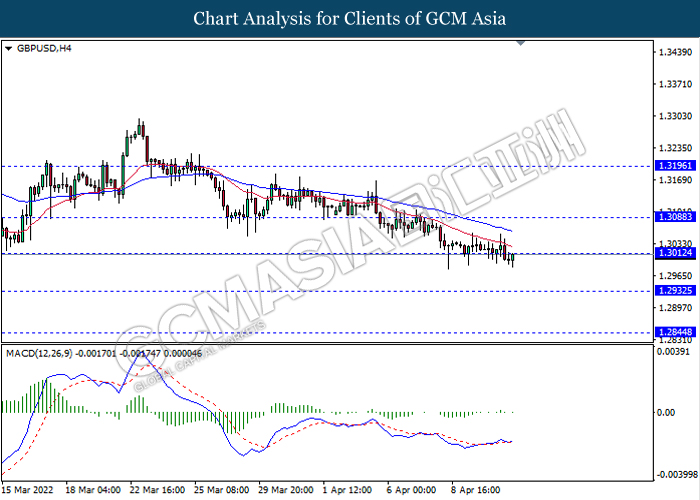

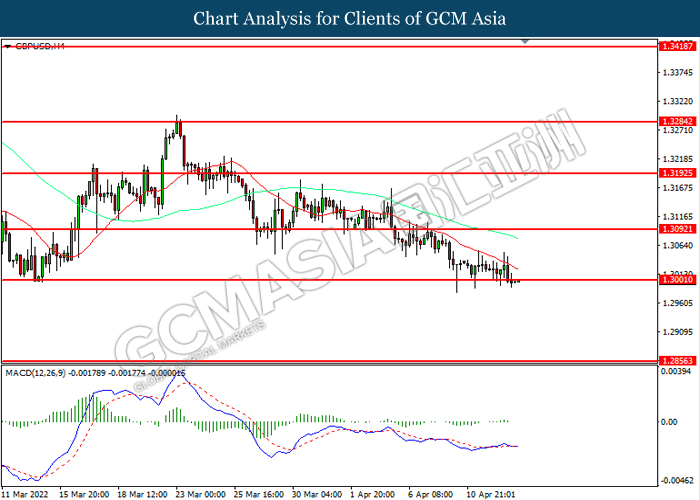

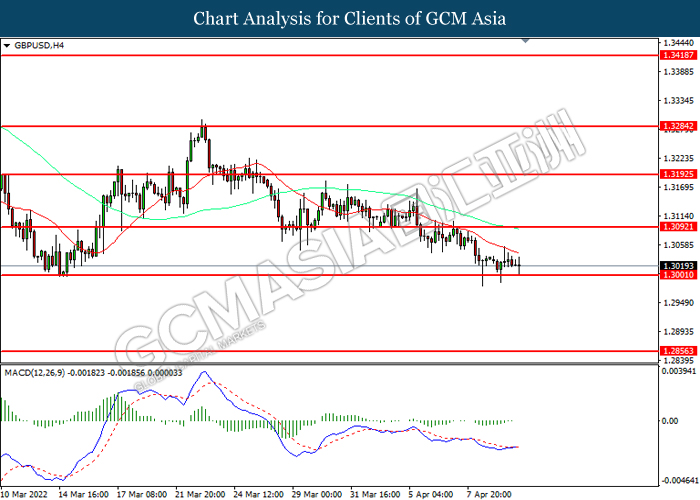

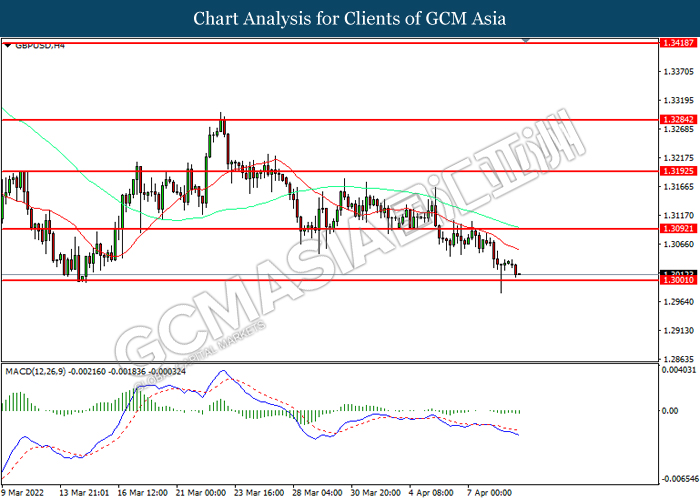

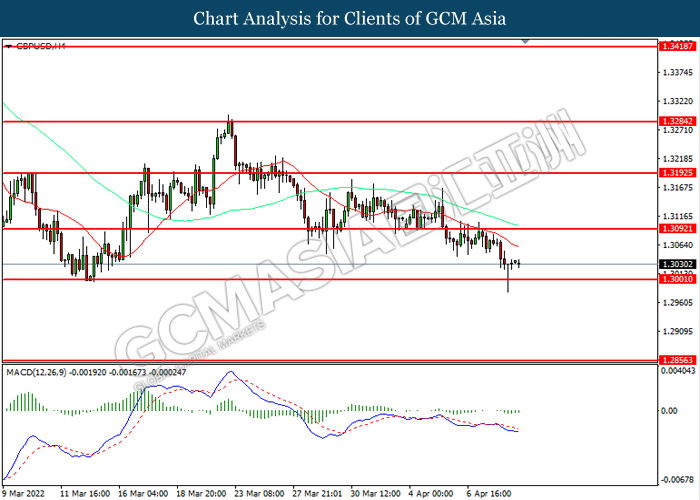

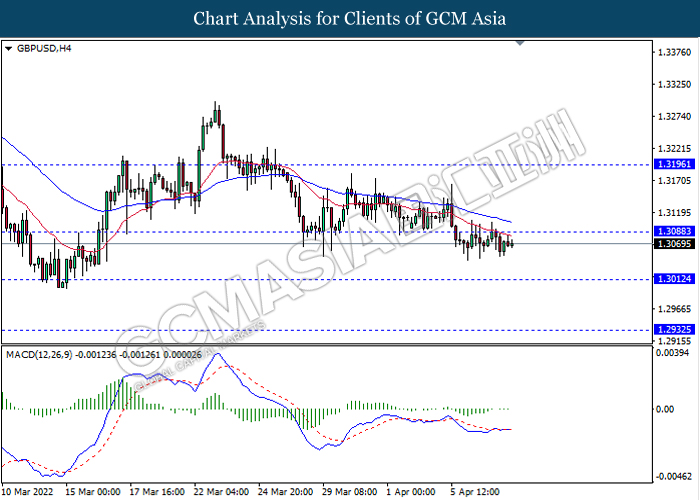

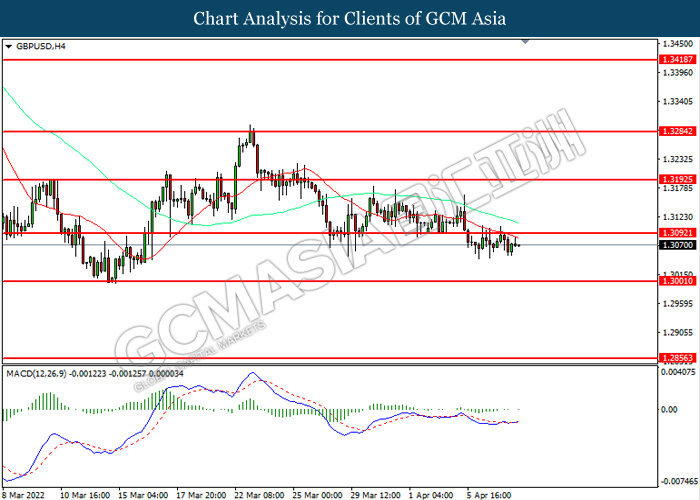

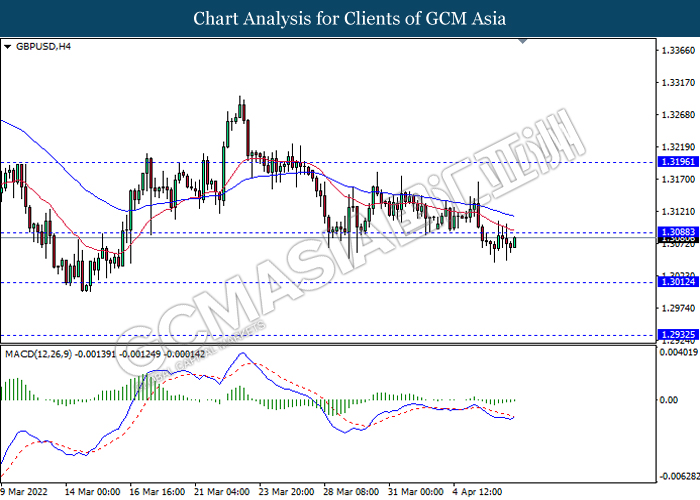

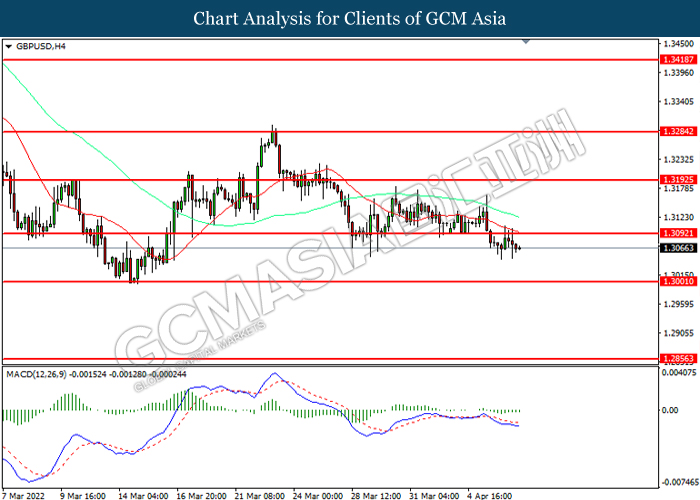

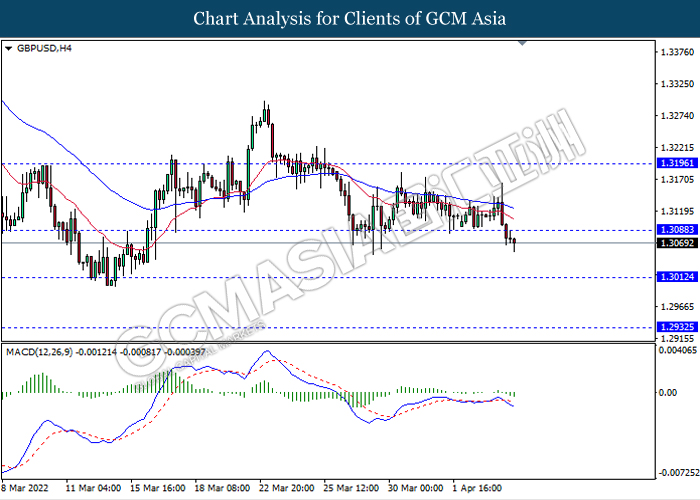

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

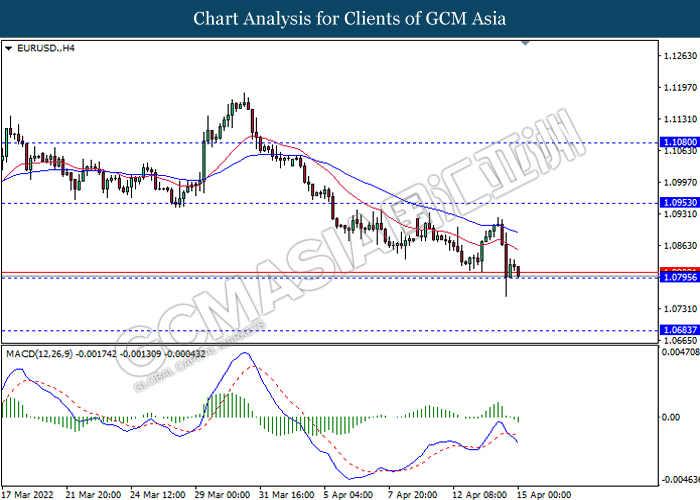

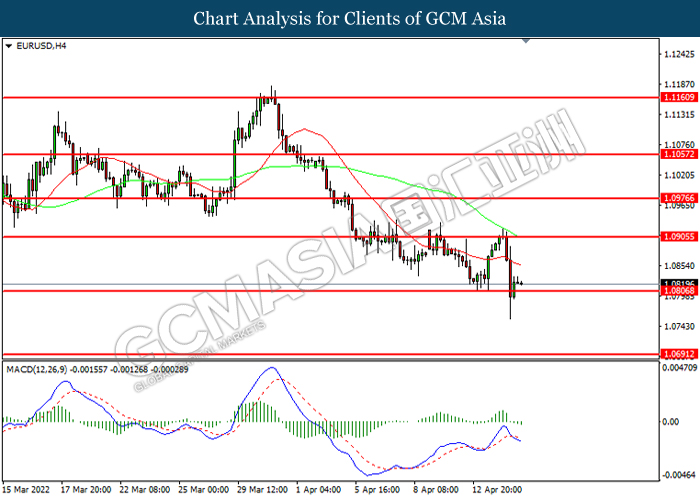

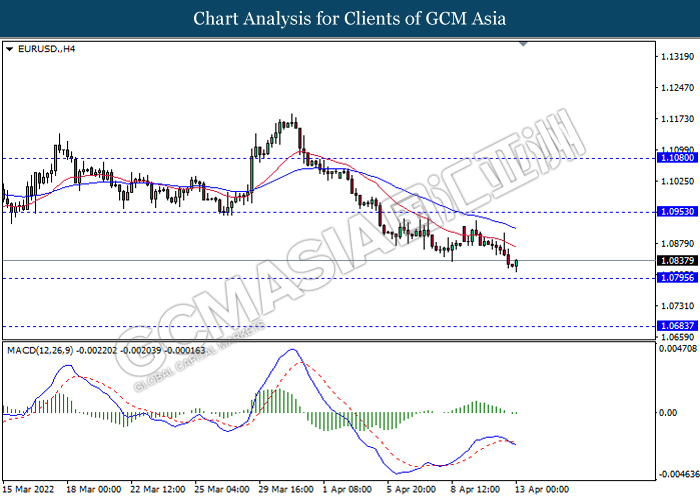

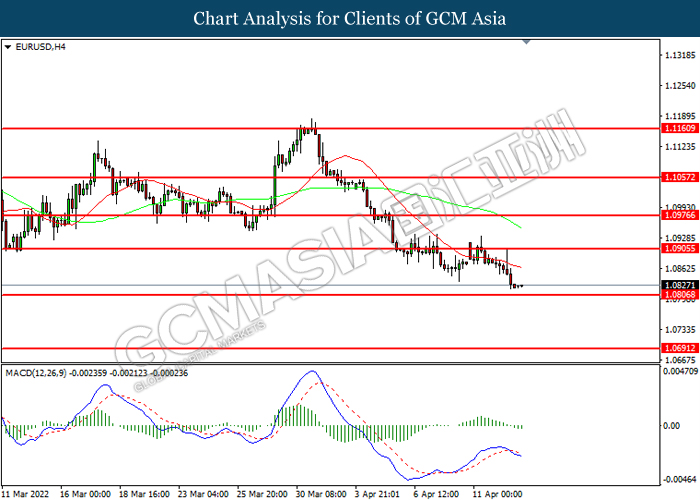

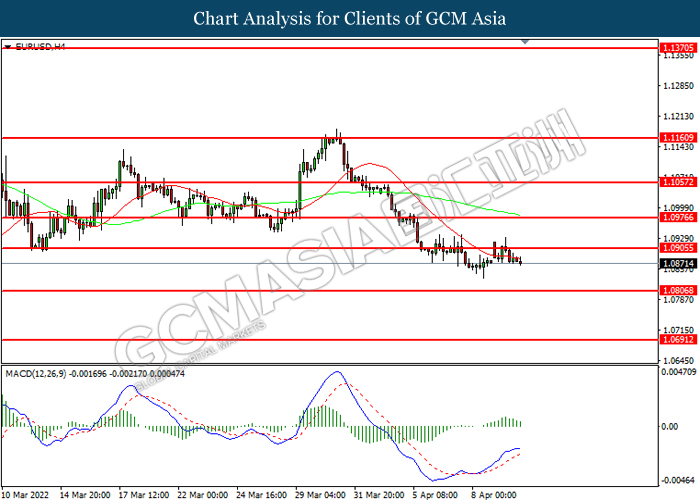

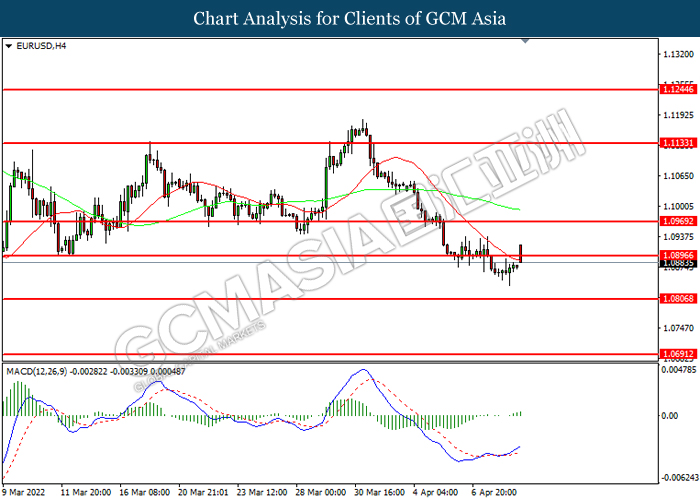

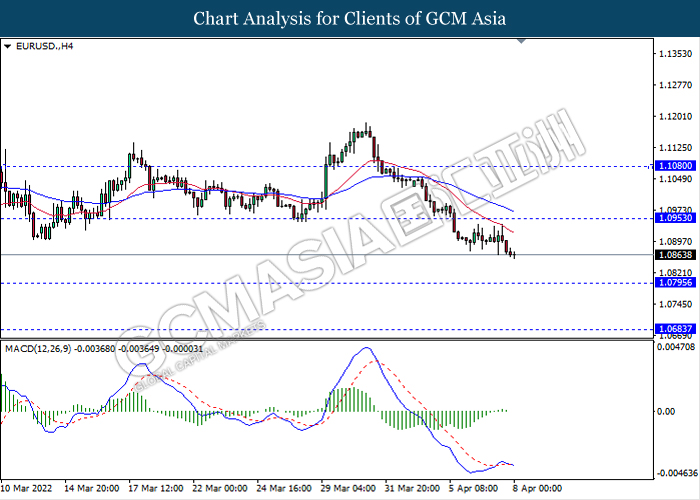

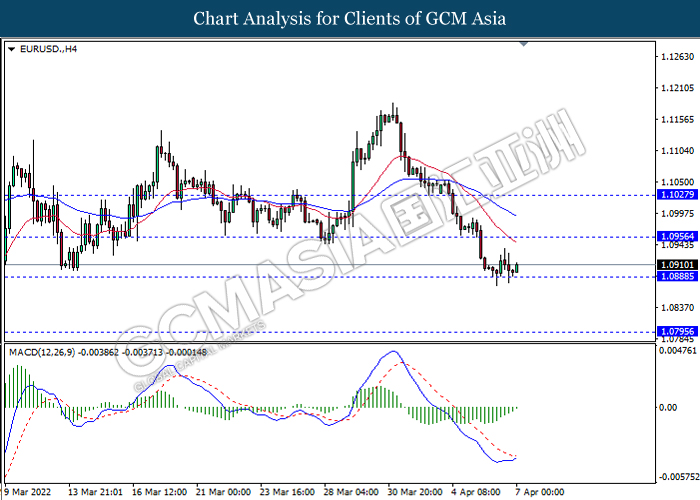

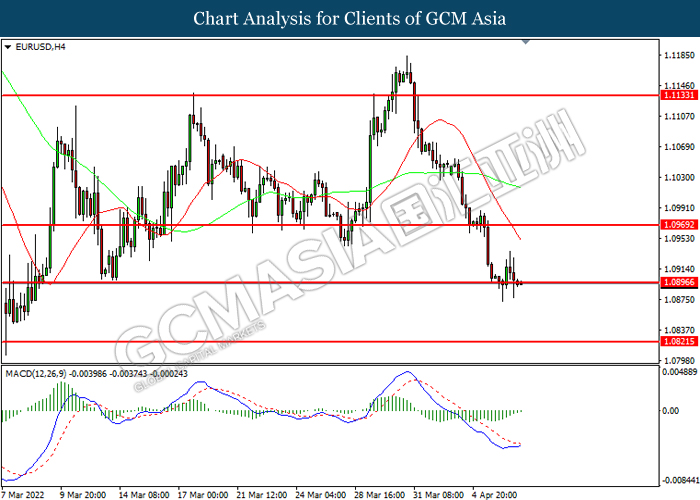

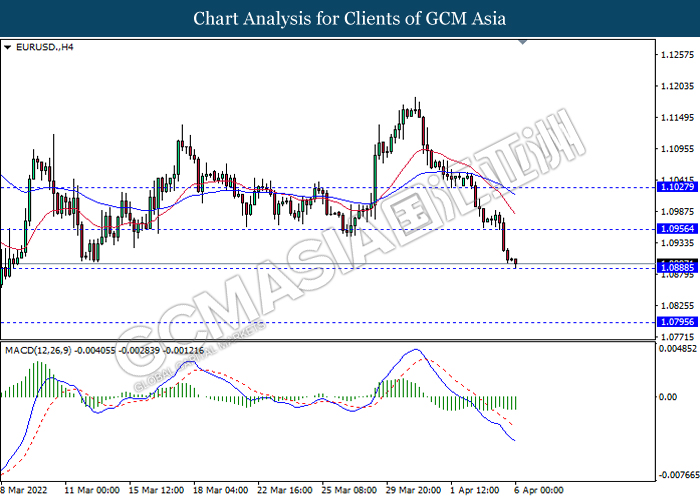

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0955, 1.1080

Support level: 1.0795, 1.0685

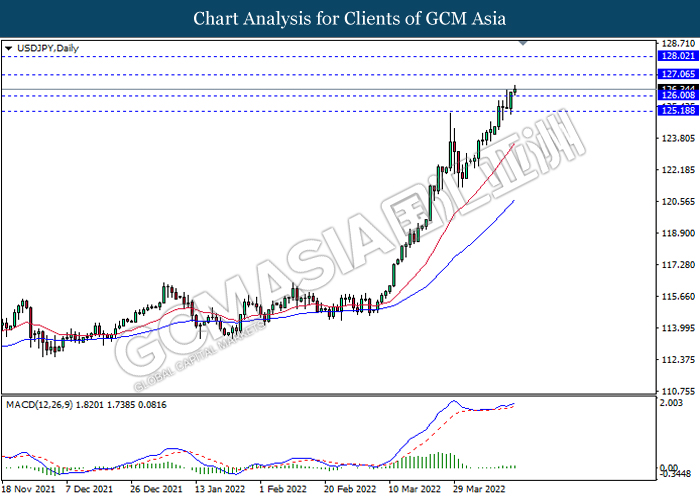

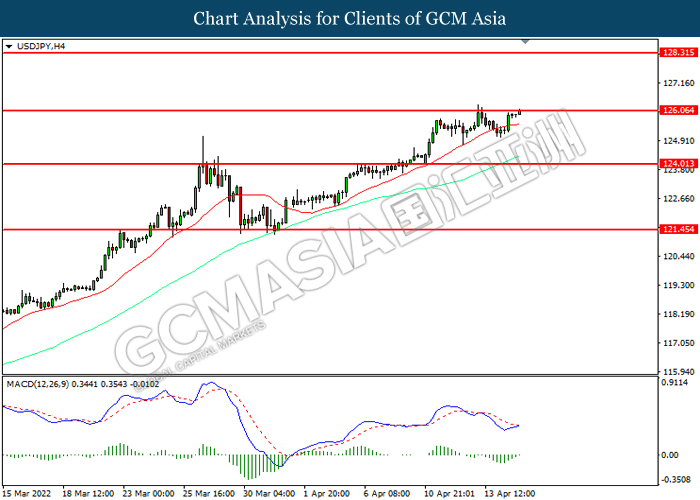

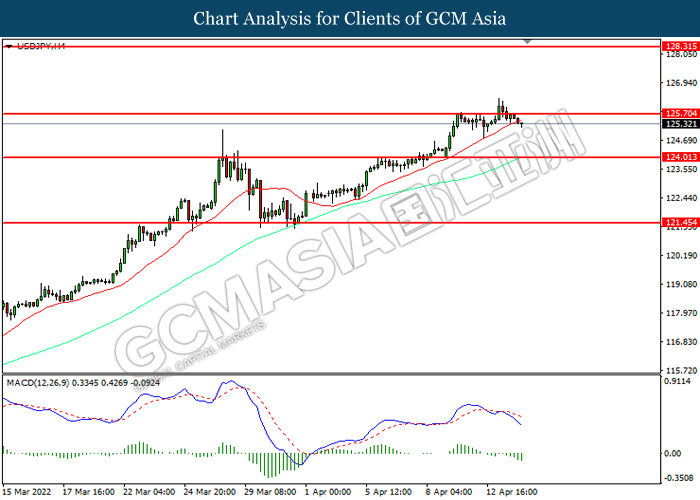

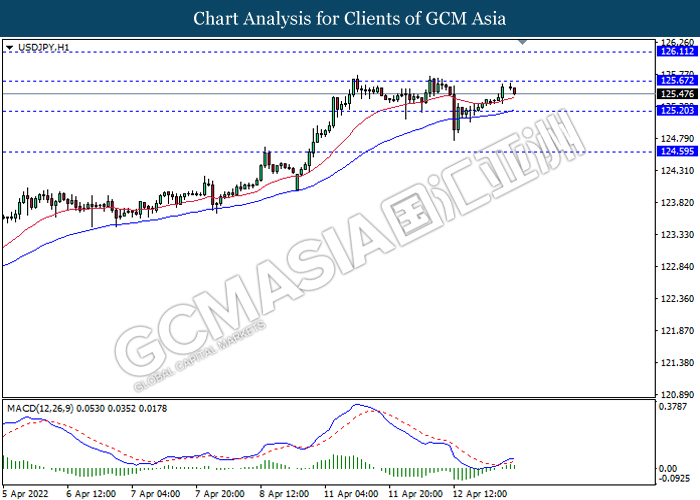

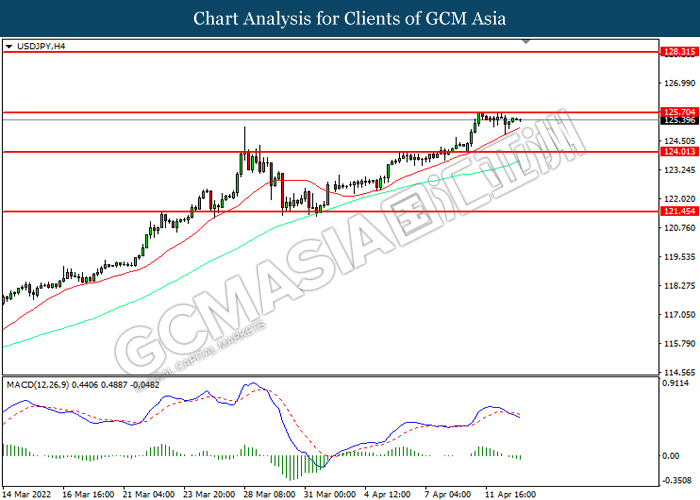

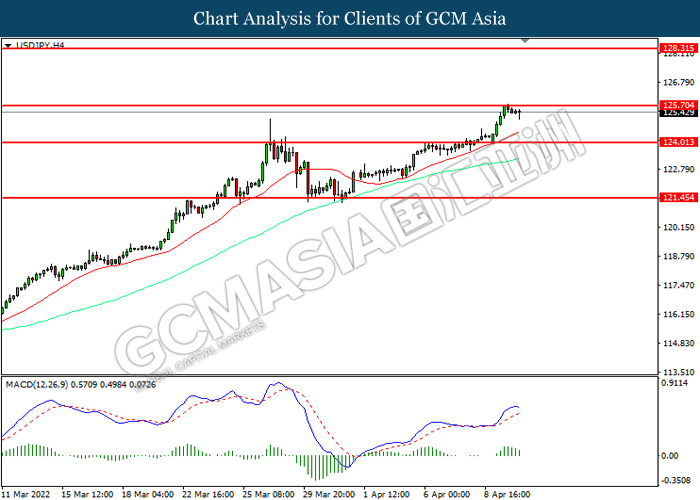

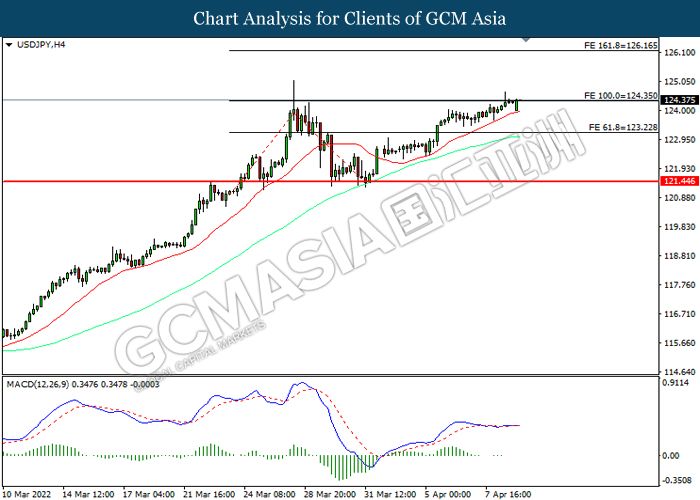

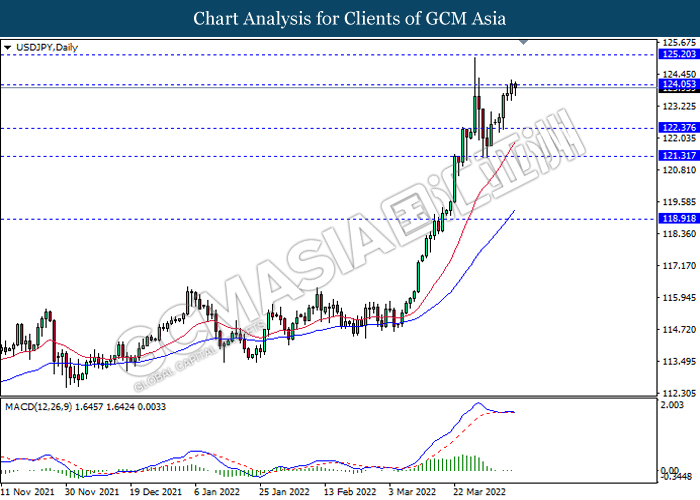

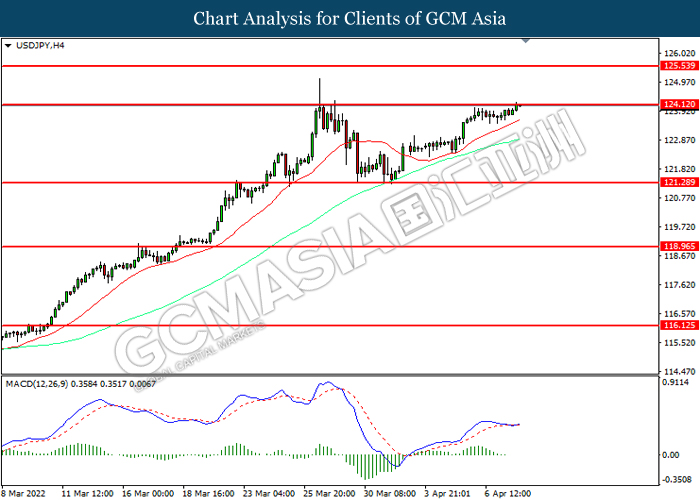

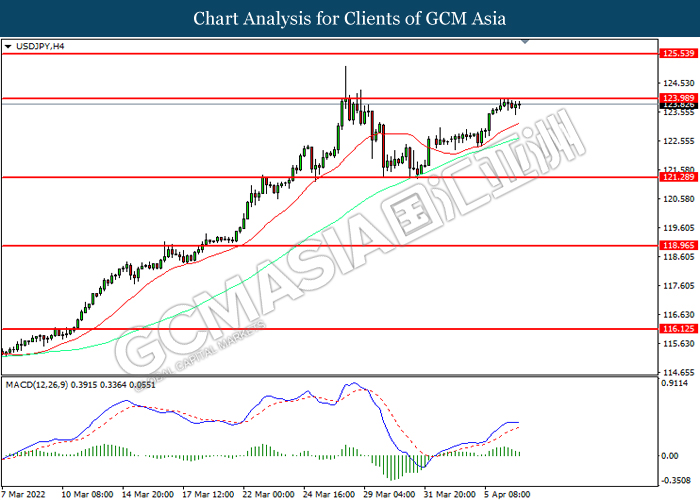

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 127.05, 128.00

Support level: 126.00, 125.20

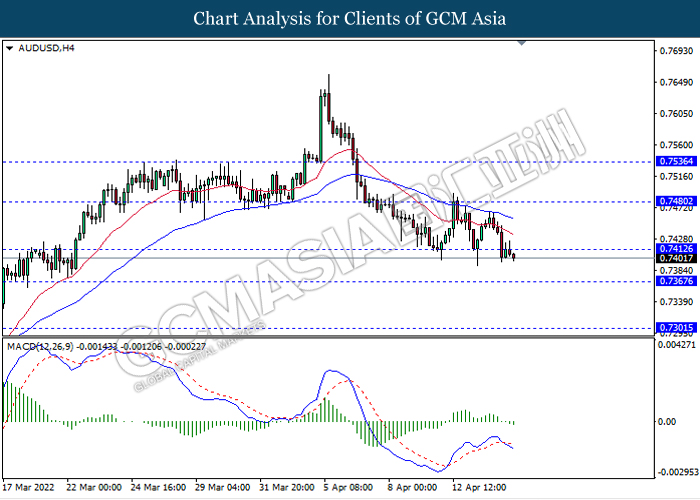

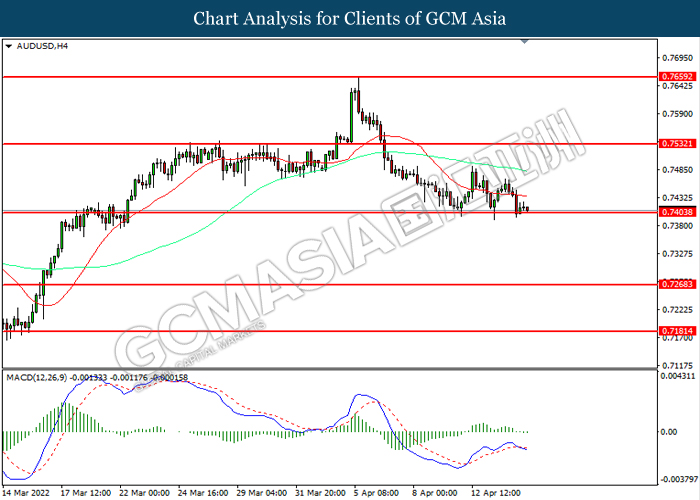

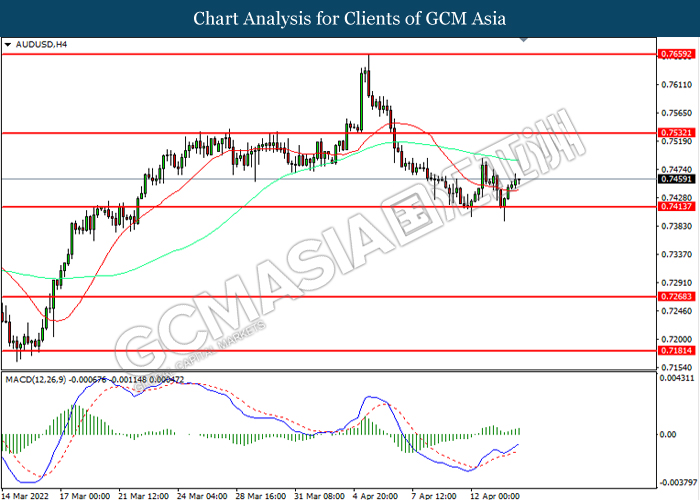

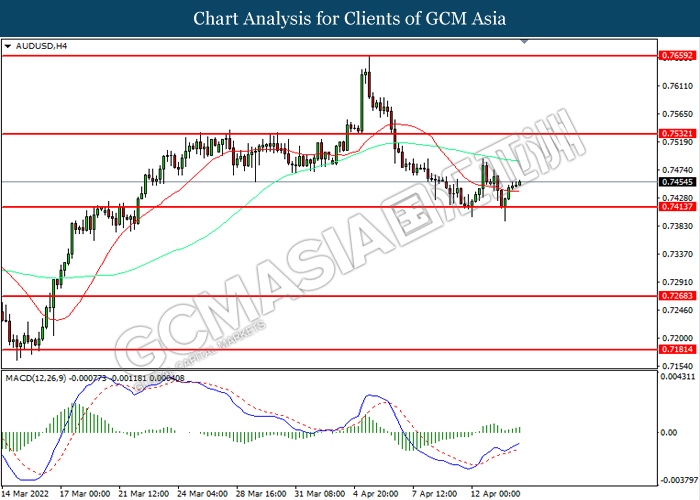

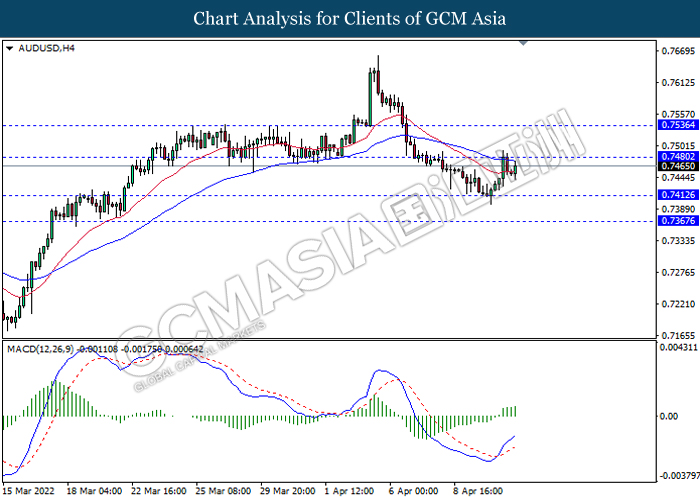

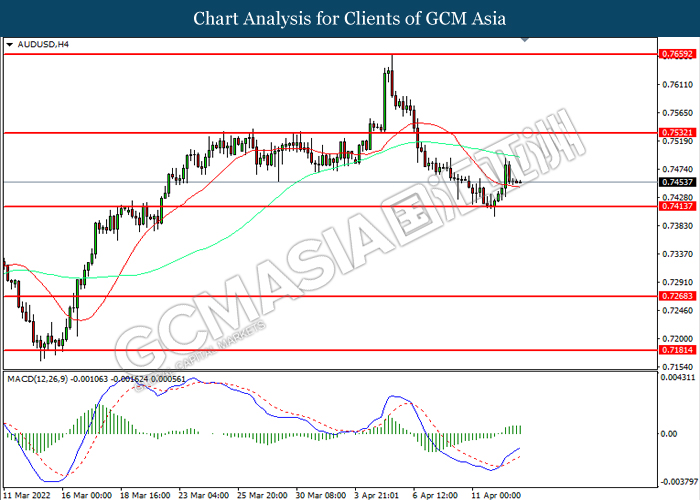

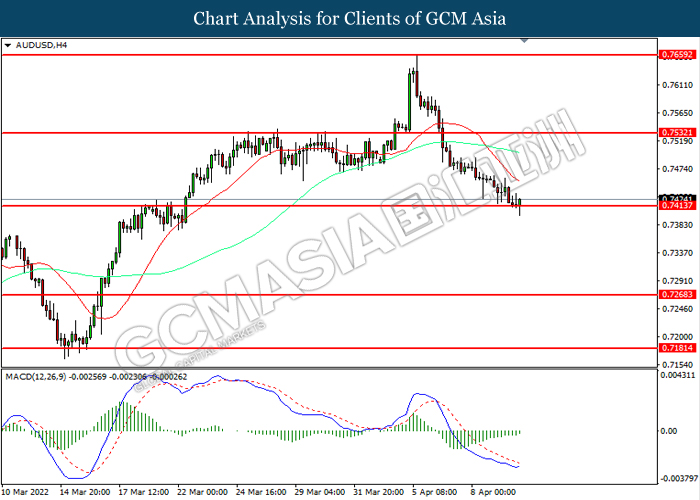

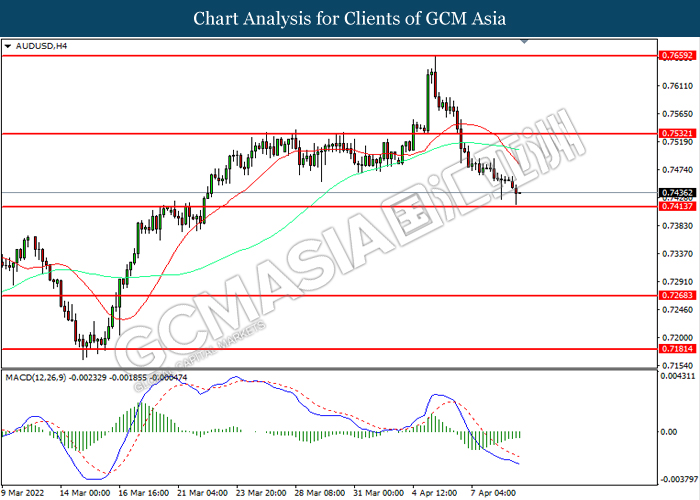

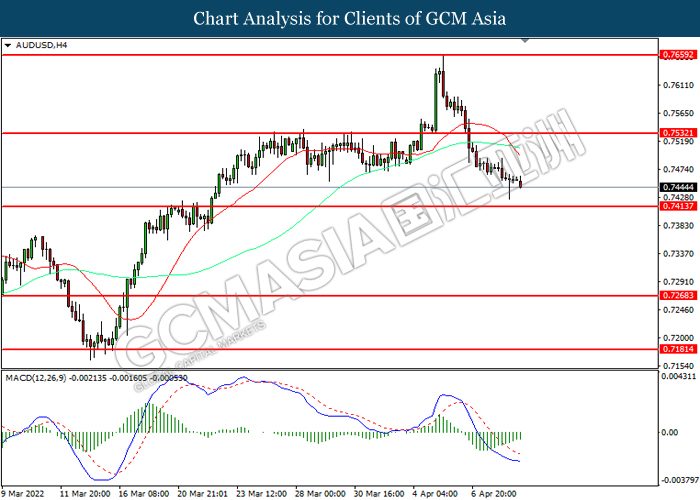

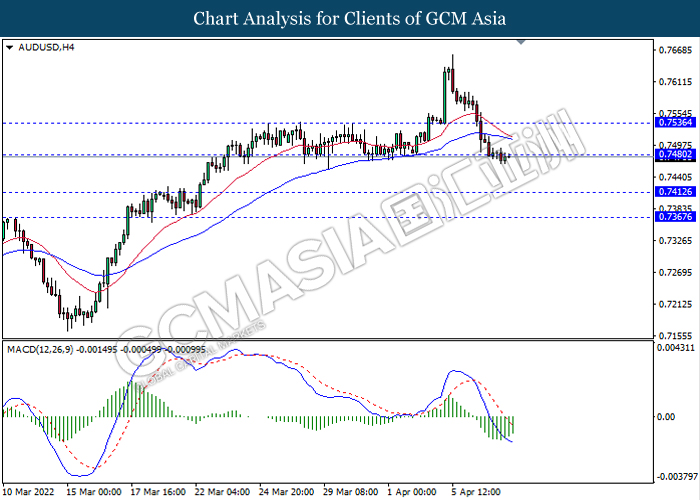

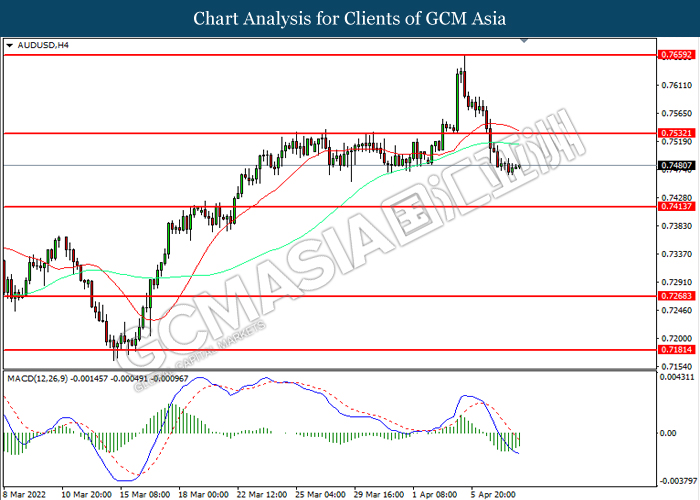

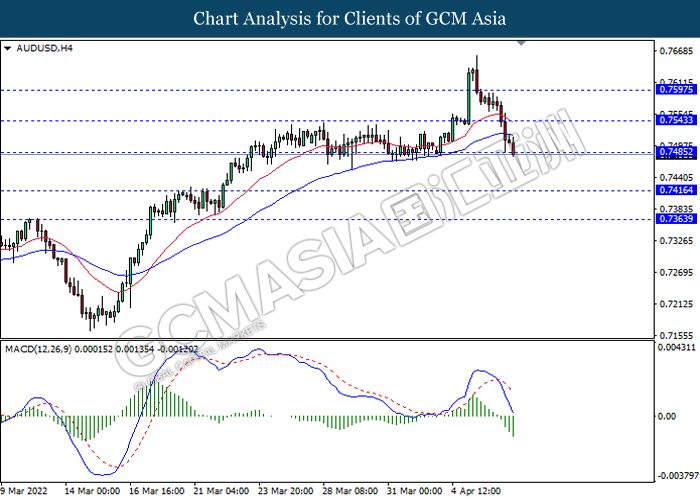

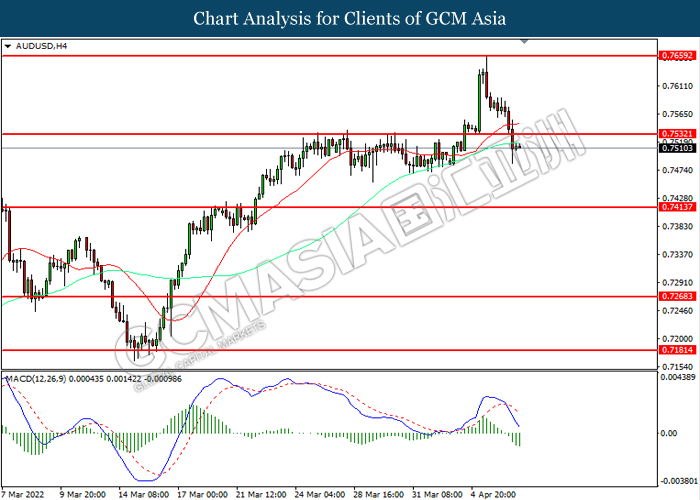

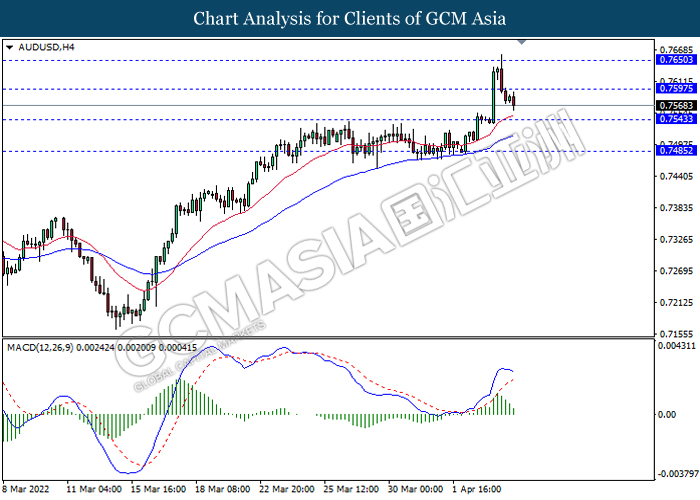

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7410, 0.7480

Support level: 0.7365, 0.7300

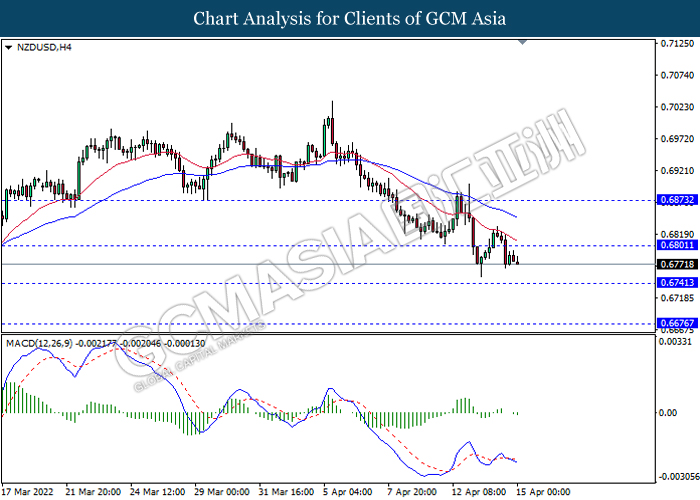

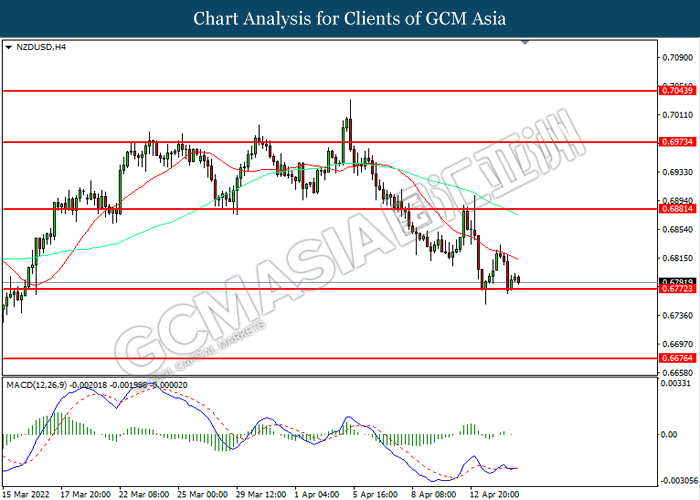

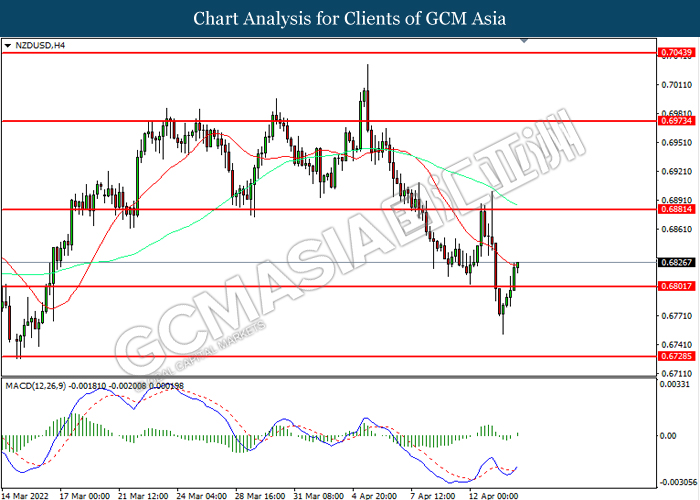

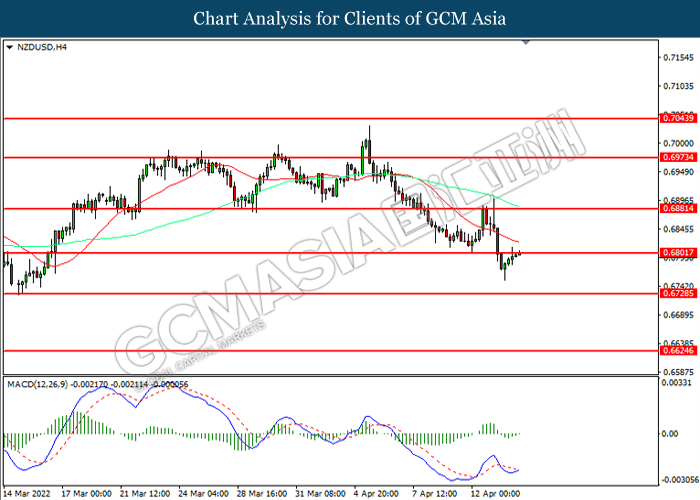

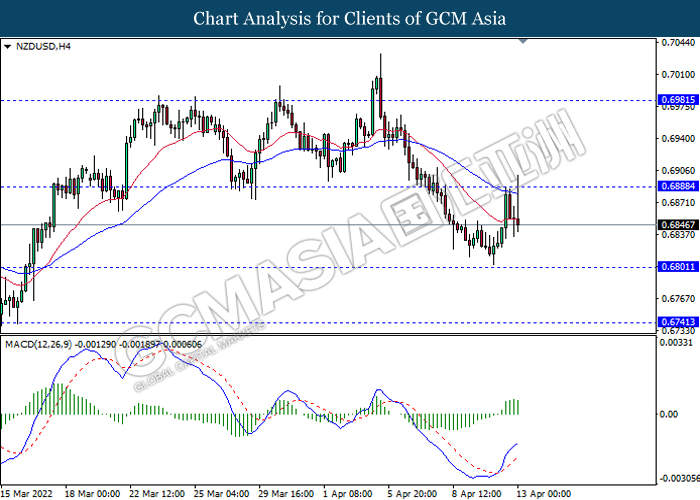

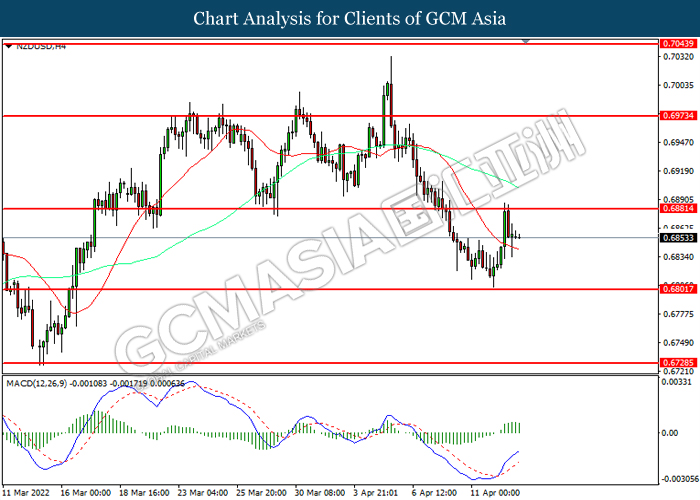

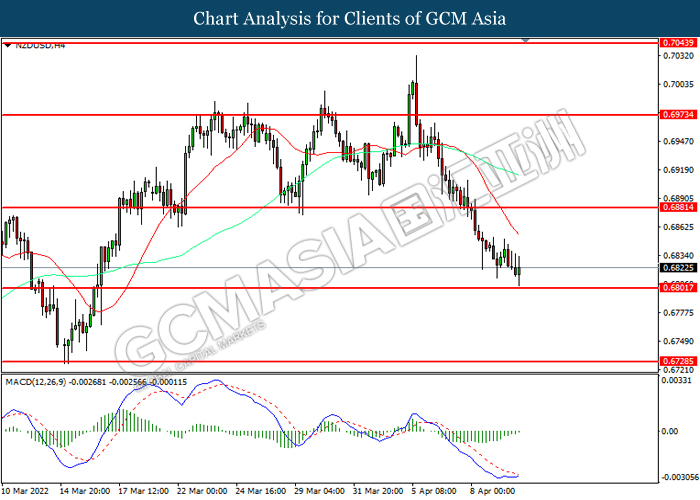

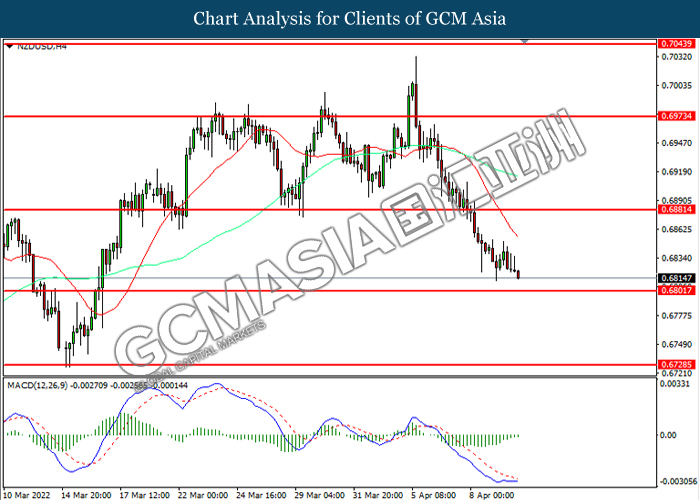

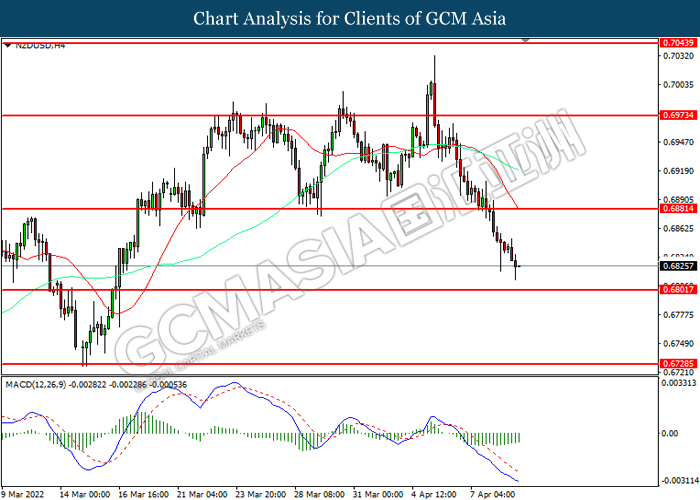

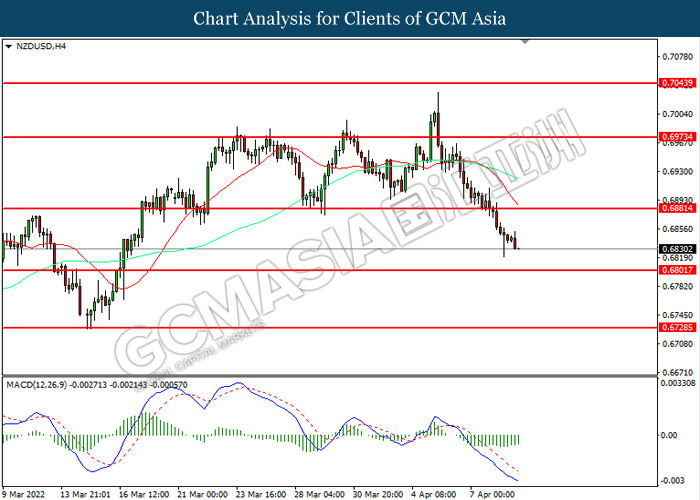

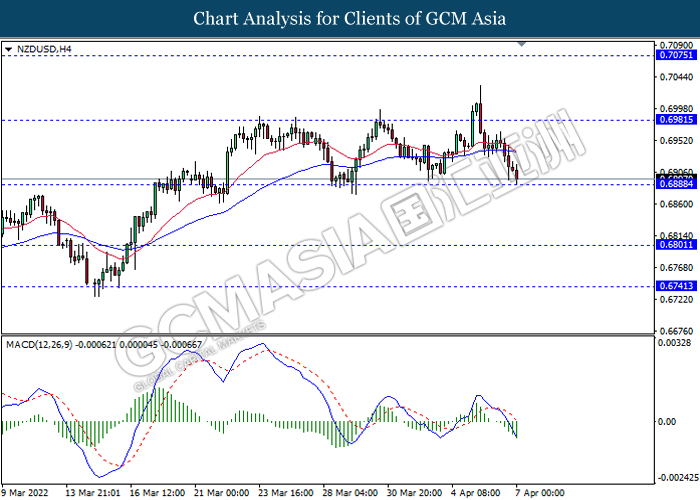

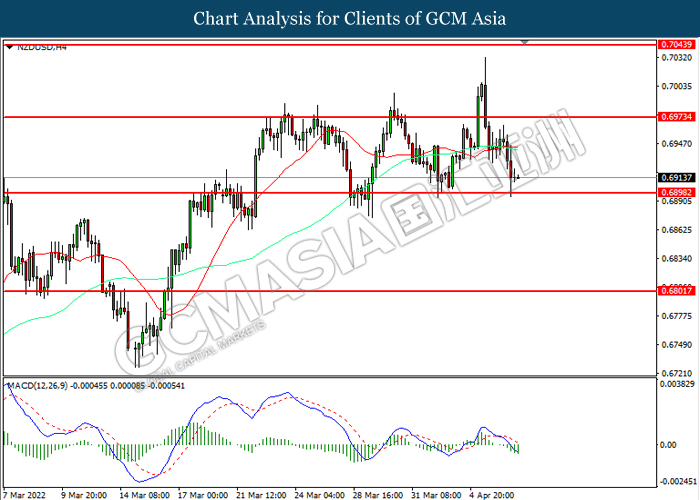

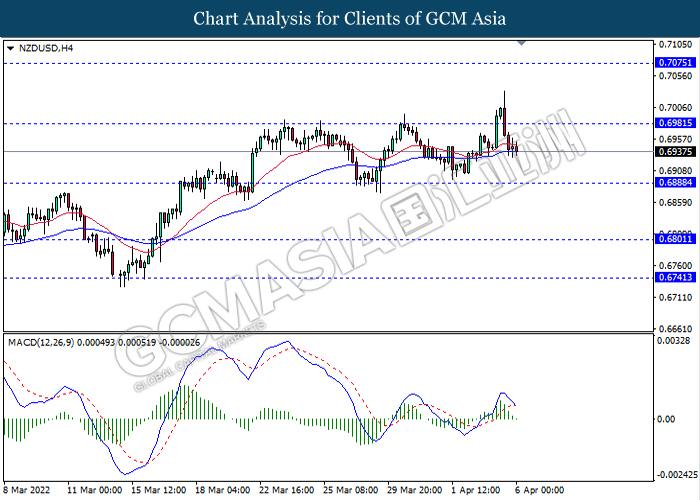

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6800, 0.6875

Support level: 0.6740, 0.6675

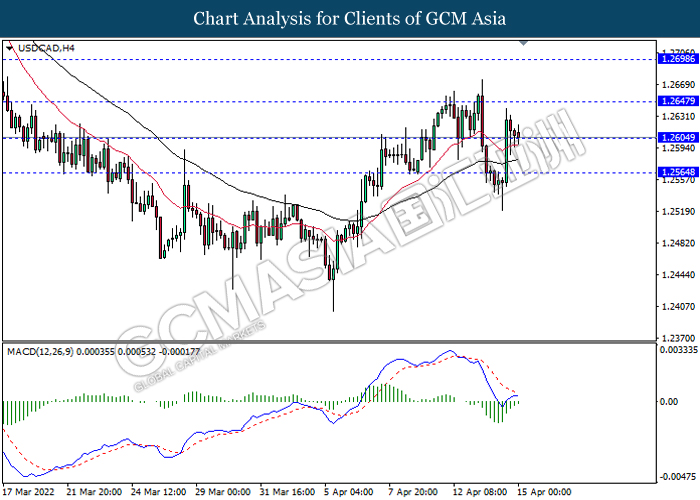

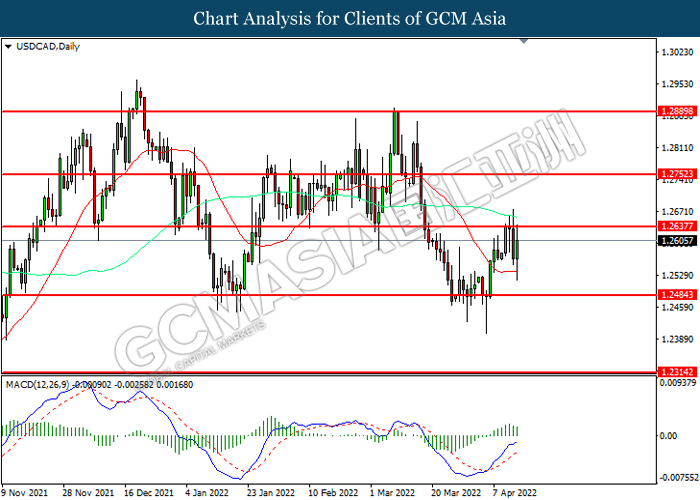

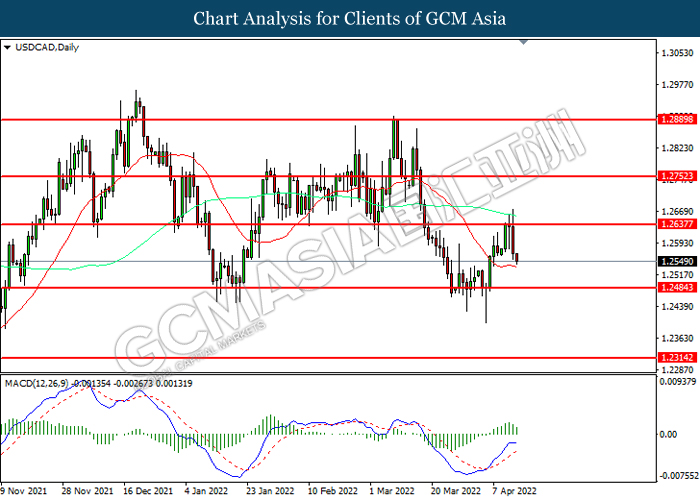

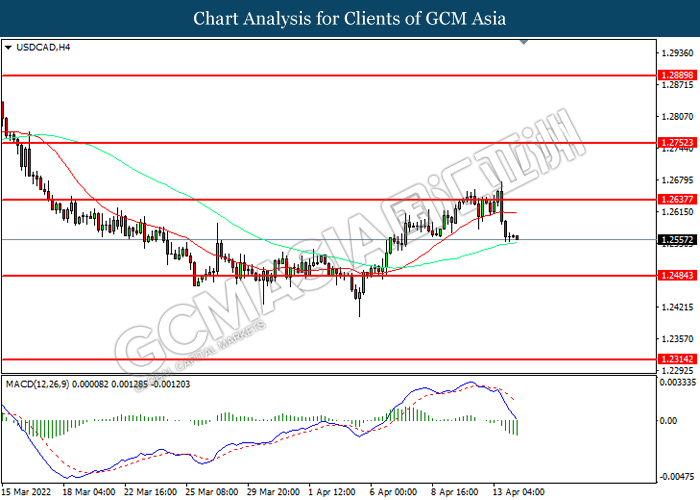

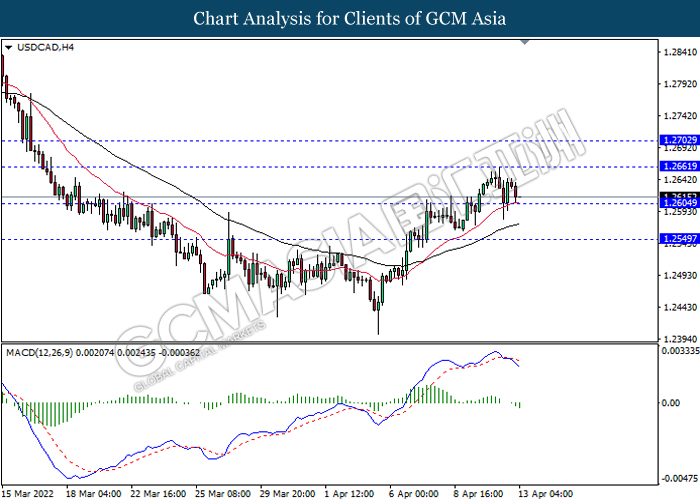

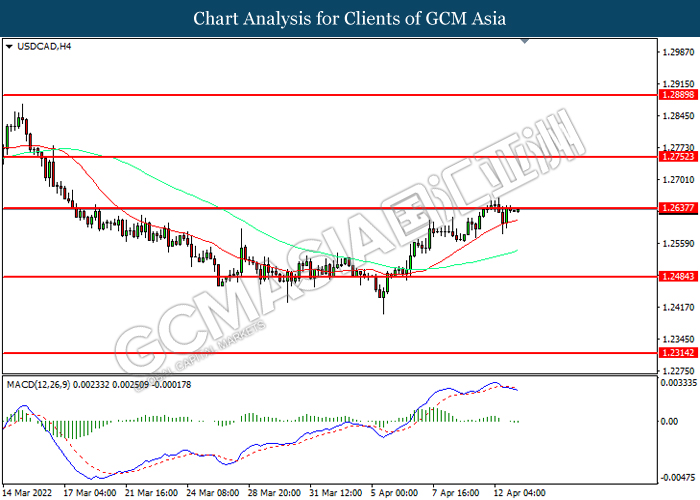

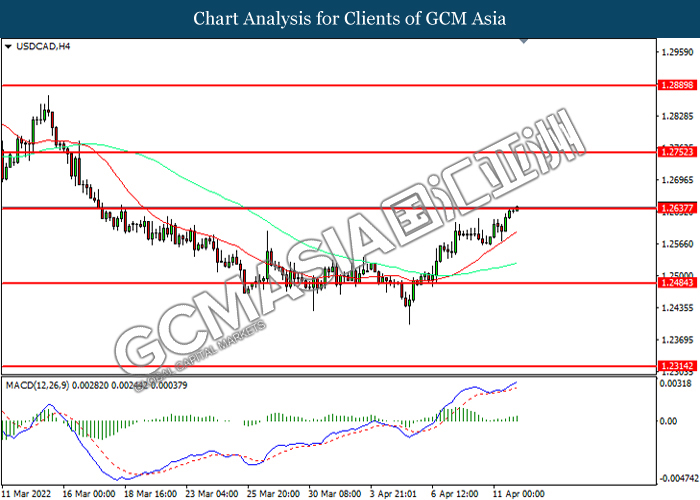

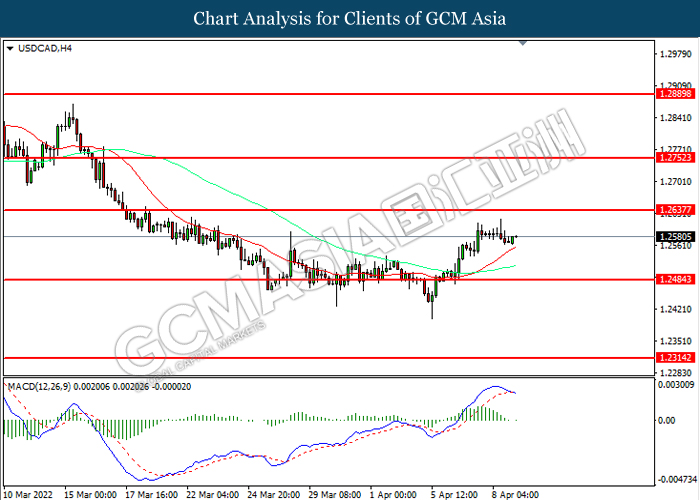

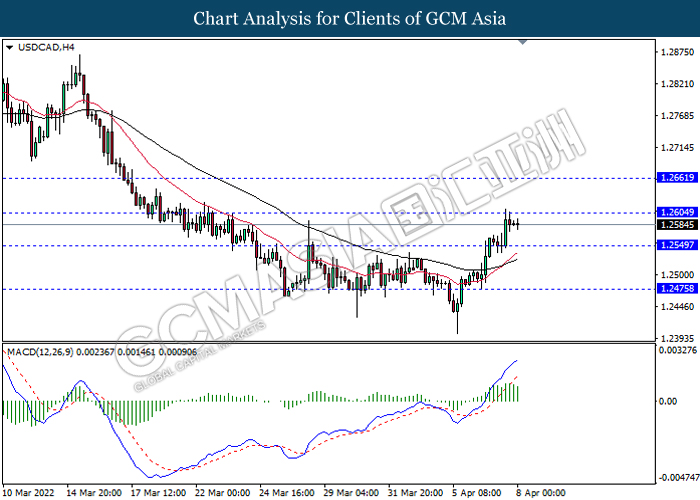

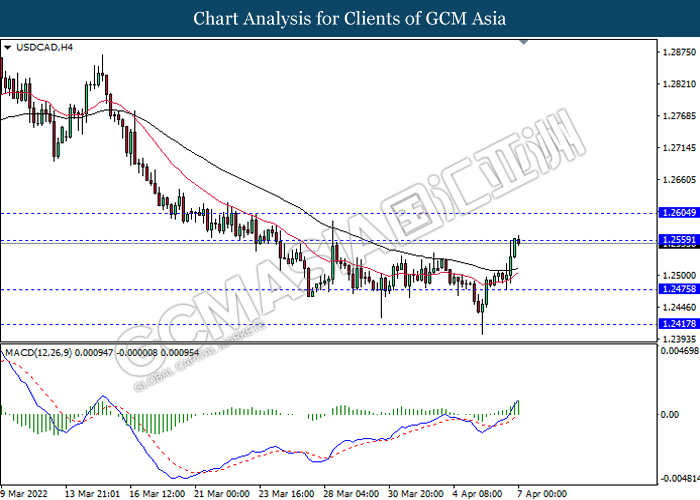

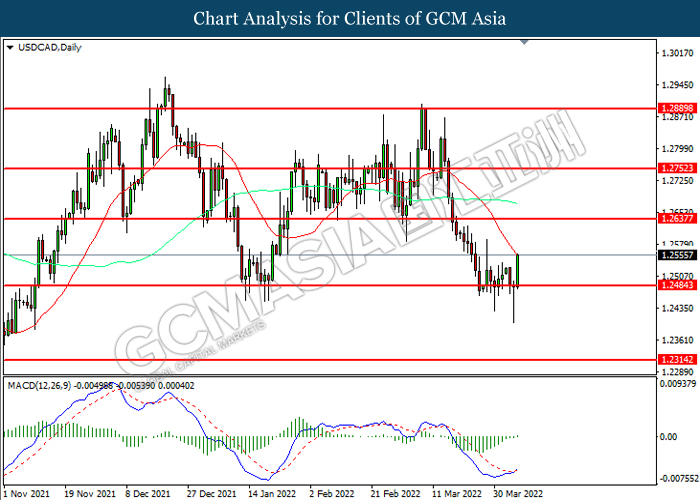

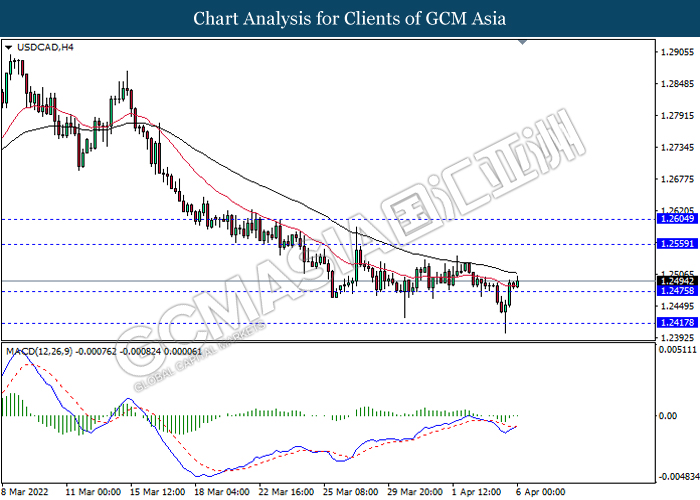

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2645, 1.2700

Support level: 1.2605, 1.2565

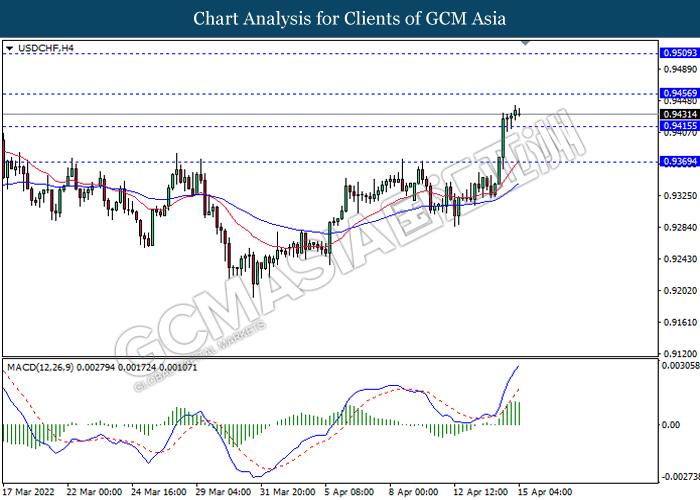

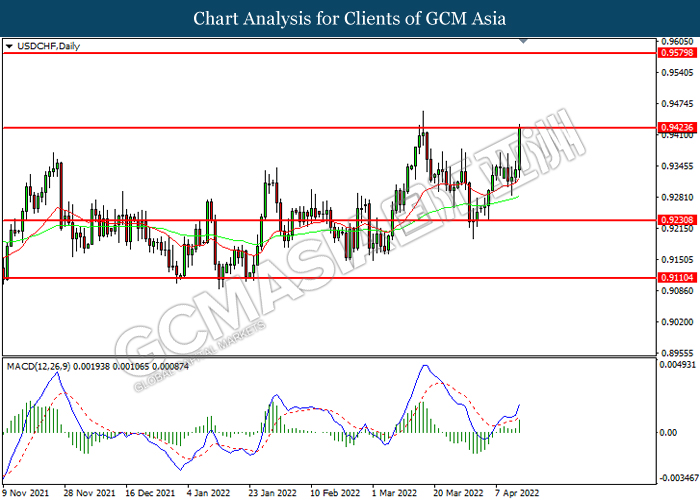

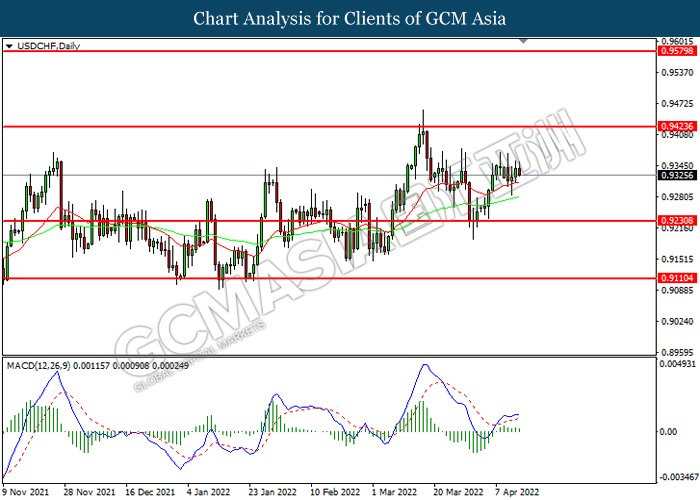

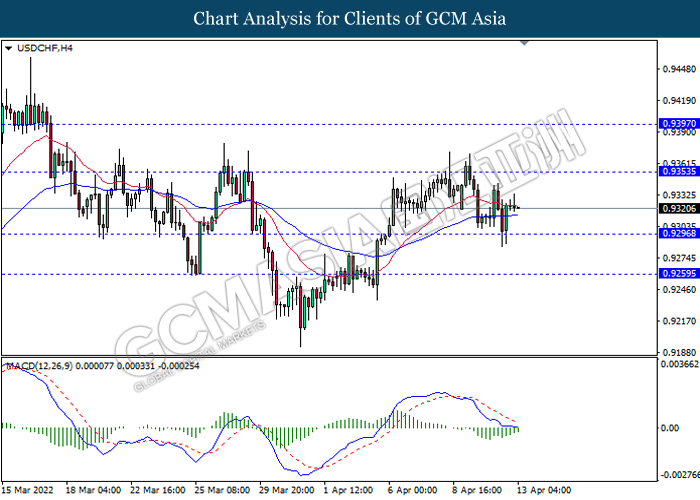

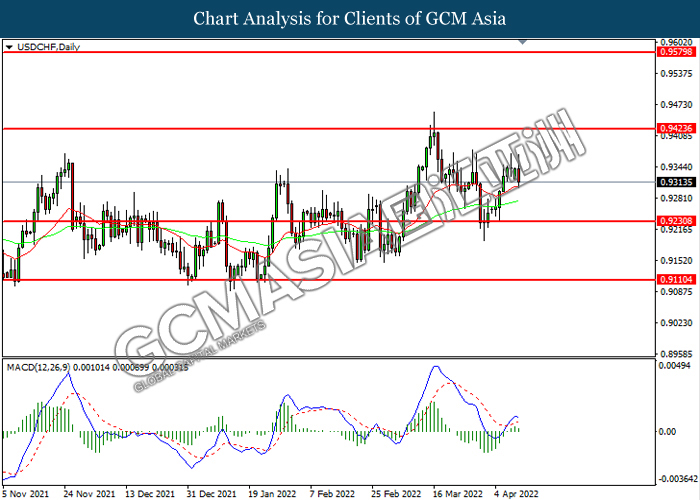

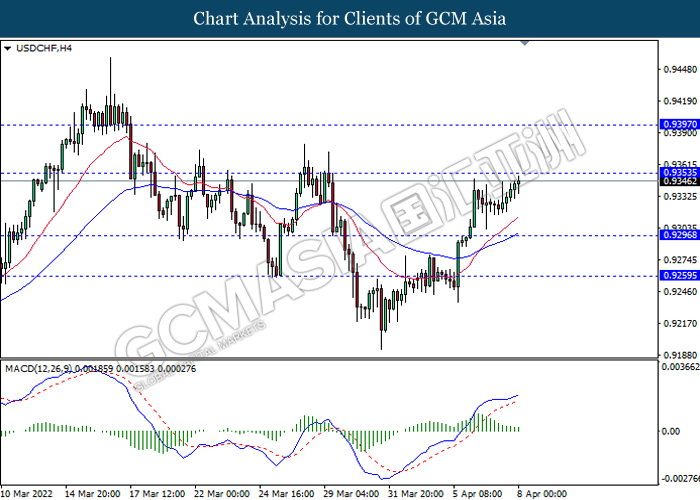

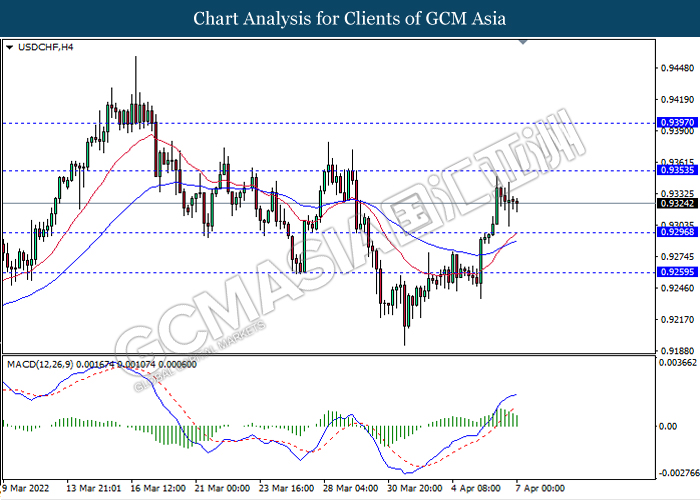

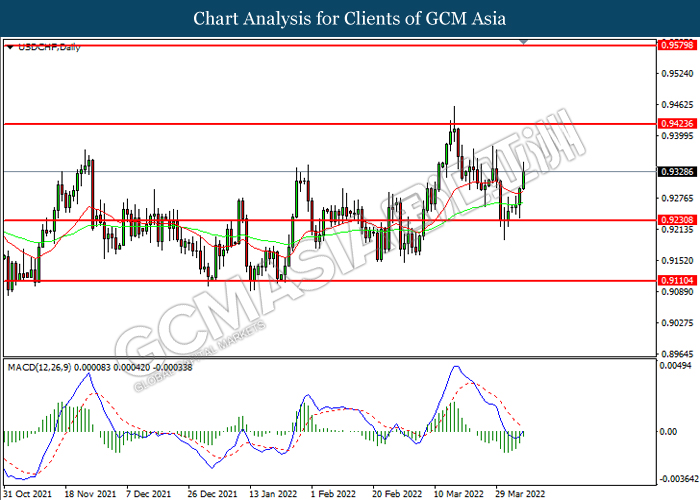

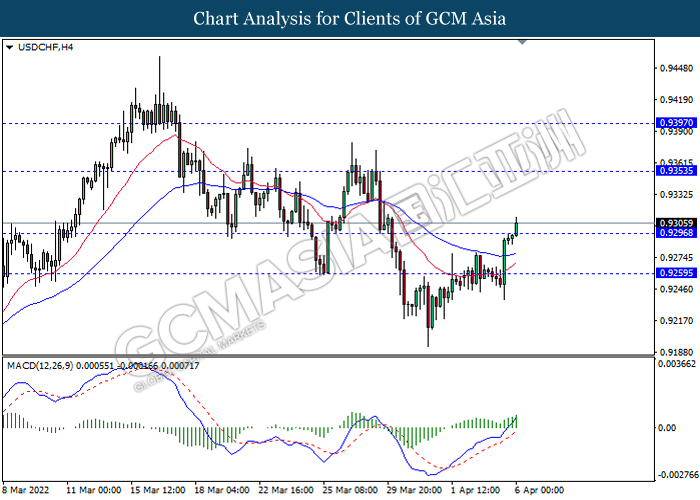

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9455, 0.9510

Support level: 0.9415, 0.9370

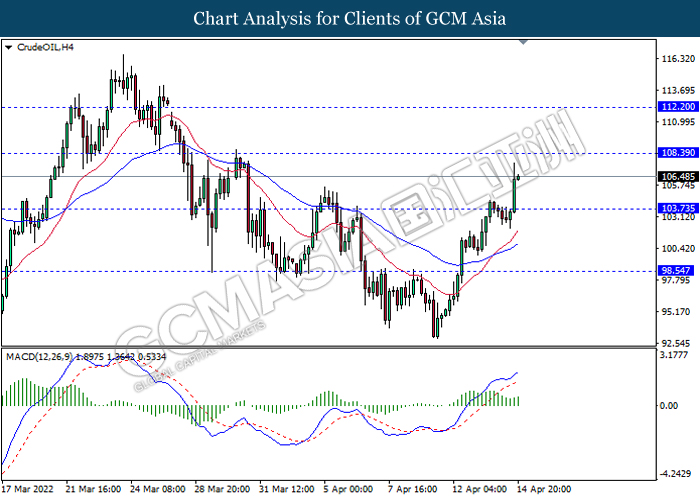

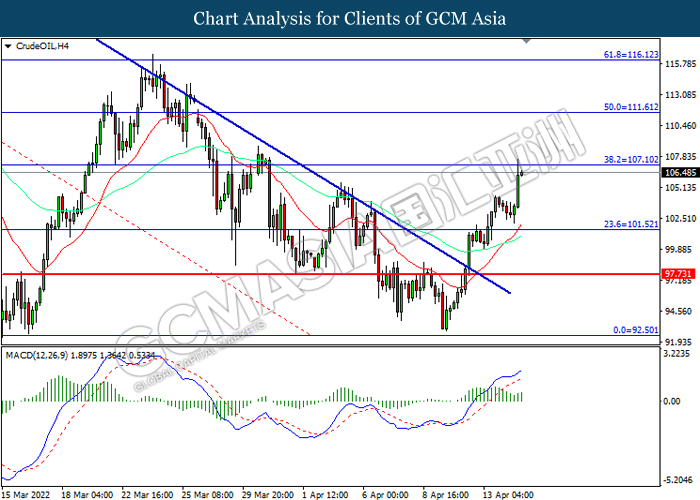

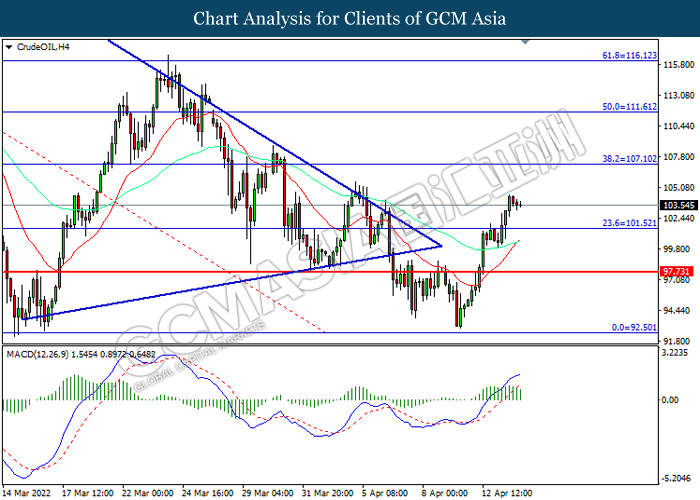

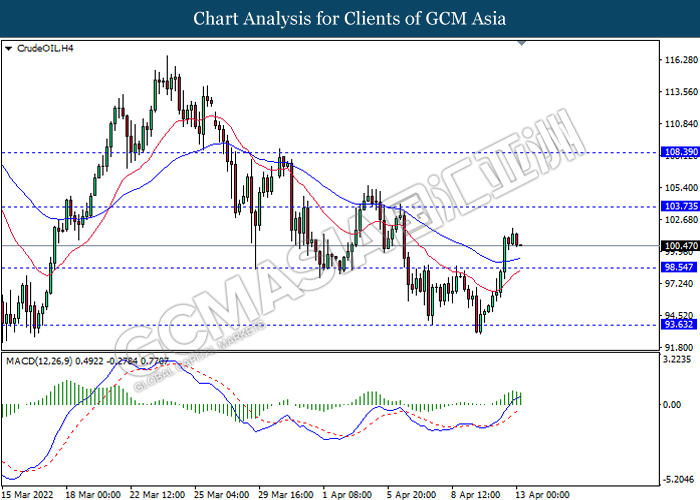

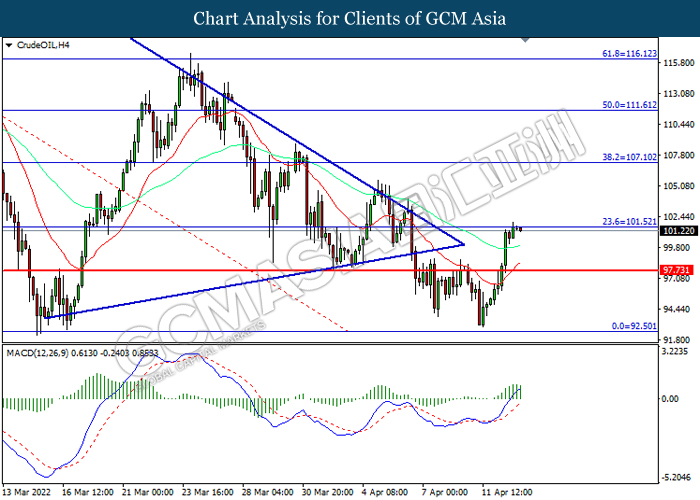

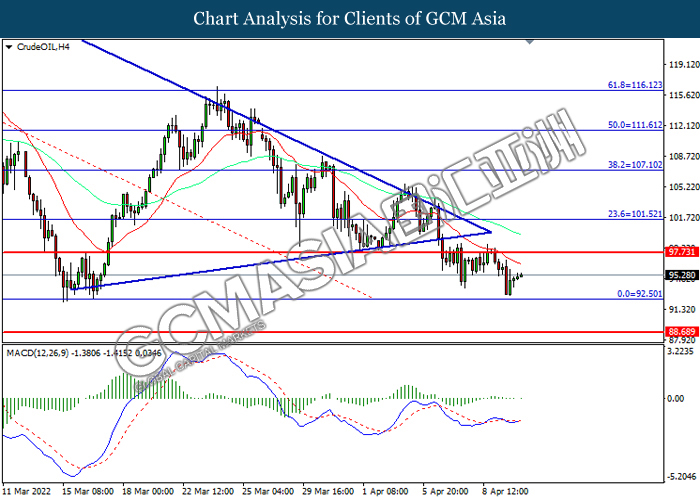

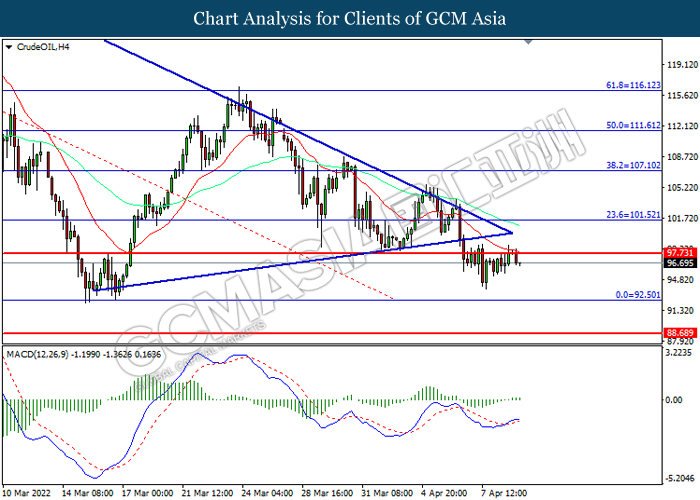

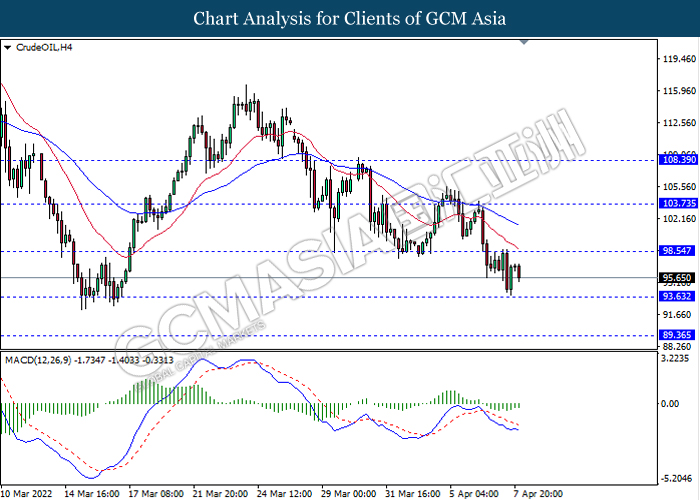

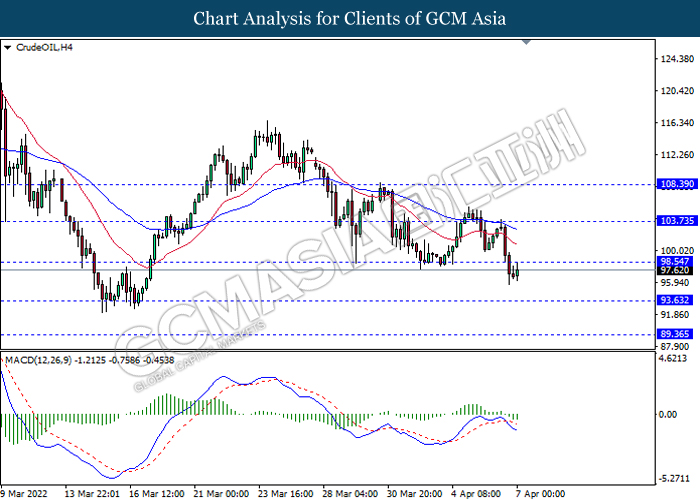

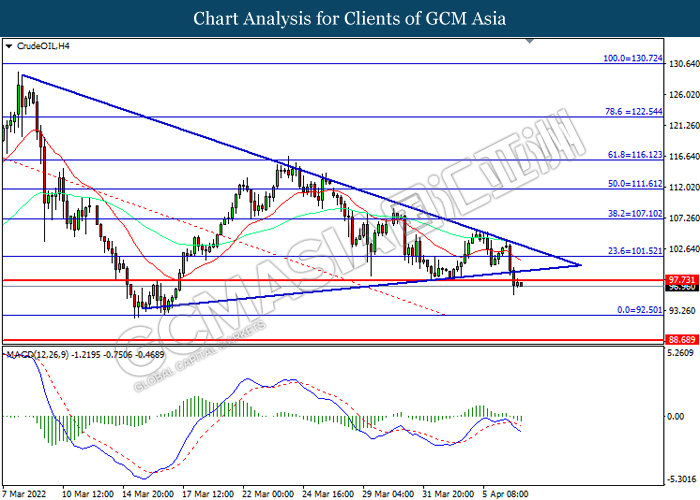

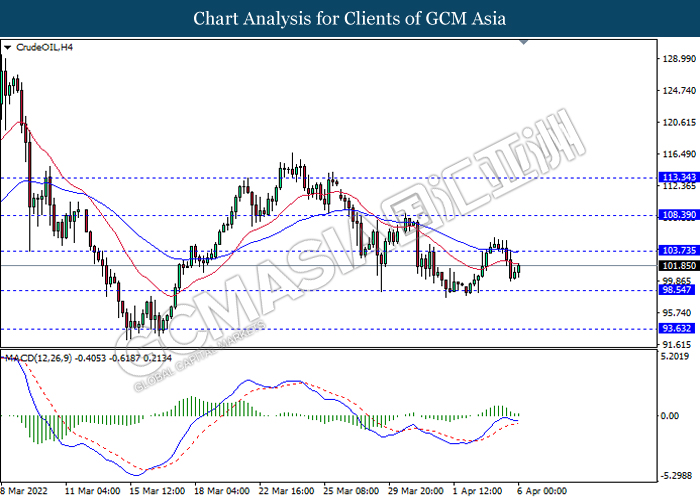

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 108.40, 112.20

Support level: 103.75, 98.55

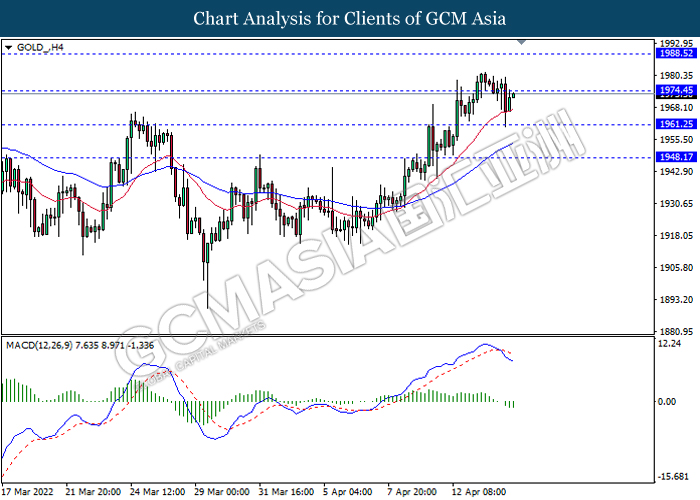

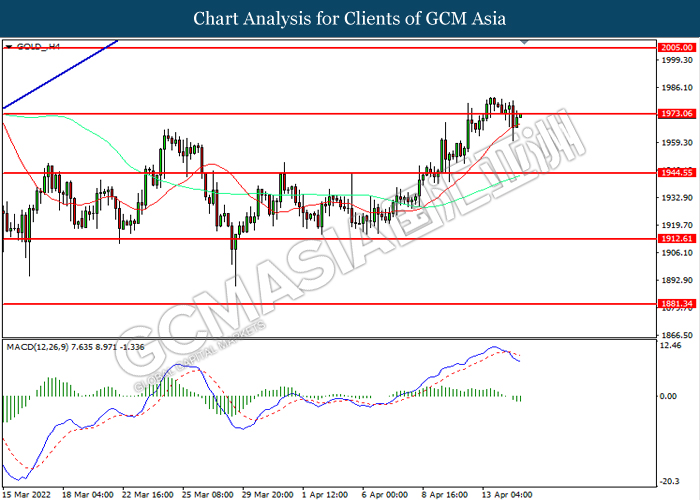

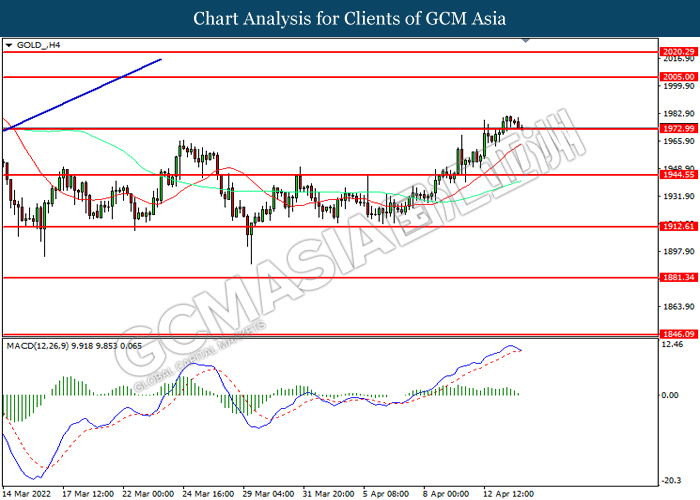

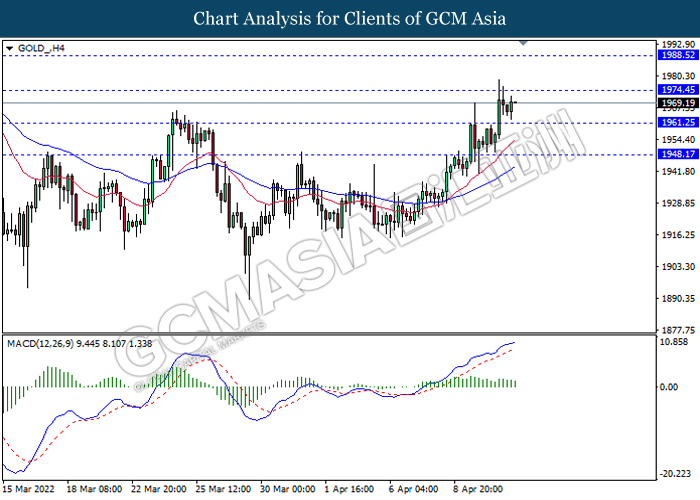

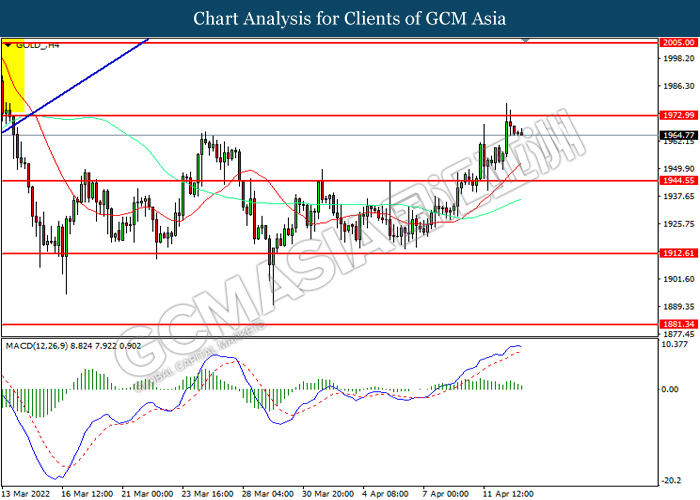

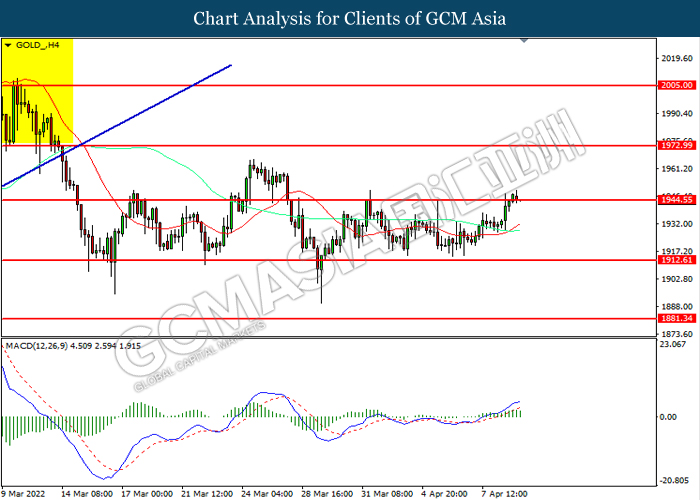

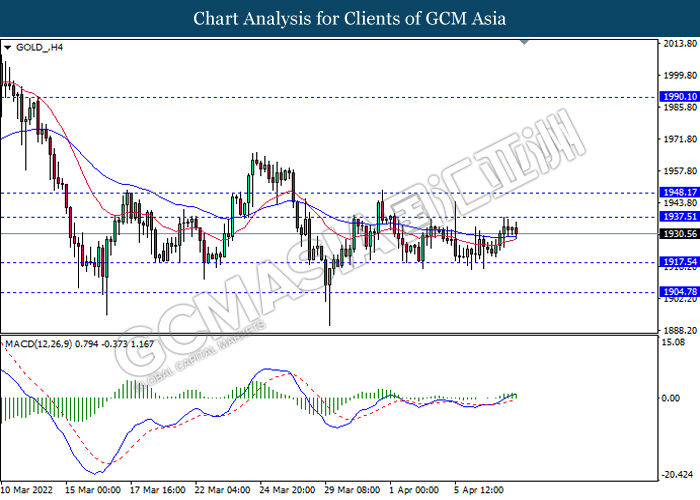

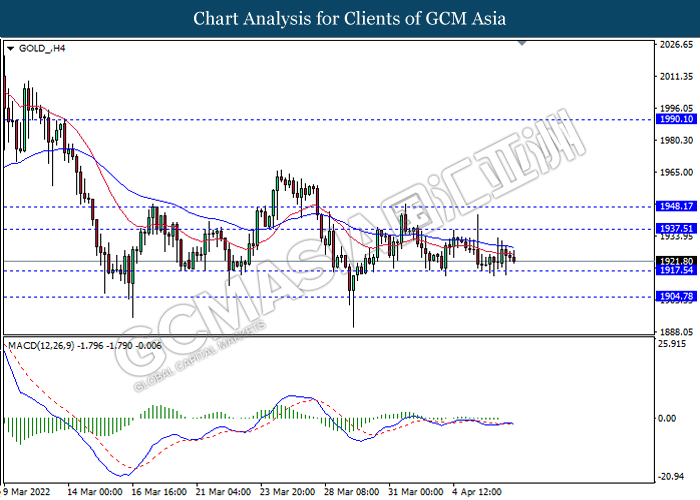

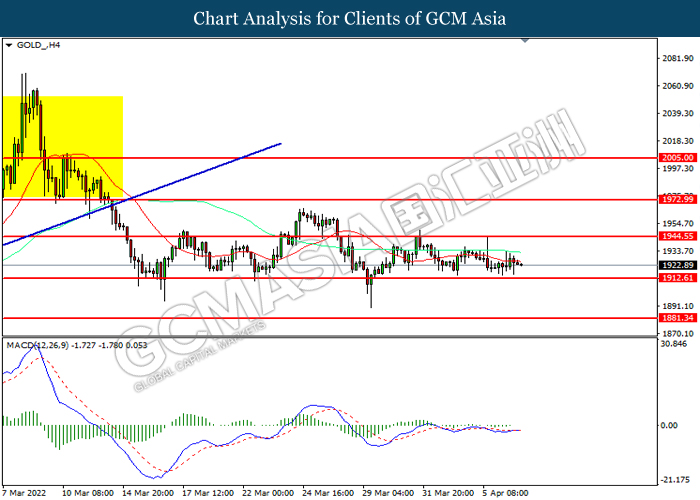

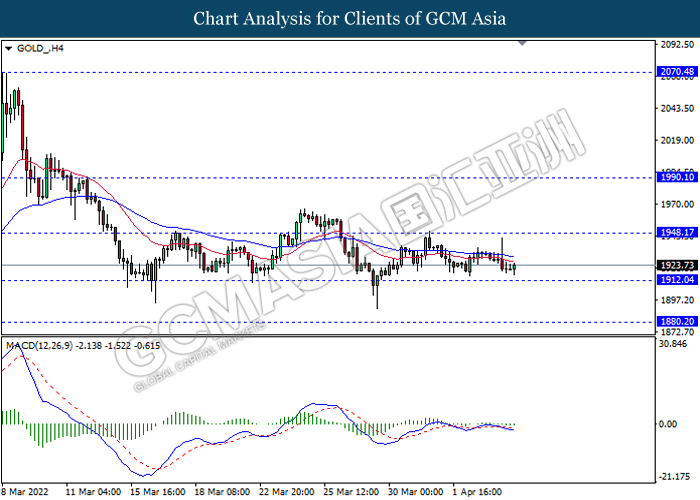

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1974.45, 1988.50

Support level: 1961.25, 1948.15

150422 Morning Session Analysis

15 April 2022 Morning Session Analysis

US Dollar surged as bullish economic data.

The Dollar Index which traded against a basket of six major currencies surged over the backdrop of a string of bullish economic data. According to Census Bureau, US Core Retail Sales for last month notched up significantly from the previous reading of 0.6% to 1.1%, exceeding the market forecast at 1.0%. The upbeat economic data had suggested that the consumer spending in United States picked up in the first quarter, dialed up the market optimism toward the economic progression in the Unite States. Nonetheless, the gains experienced by the US Dollar was limited by negative job data. Department of Labor reported that the US Initial Jobless Claims came in at 185K, missing the market forecast at 171K. On the other hand, the dovish tone from the European Central Bank on yesterday had dragged down the appeal for Euro, which prompting investors to shift their portfolio from the European region into US market. As of writing, the Dollar Index appreciated by 0.46% to 100.35.

In the commodities market, the crude oil price appreciated by 2.17% to $106.48 per barrel as of writing. The oil market edged higher as market participants speculated that the implementation of the oil sanction from EU to Russia would likely to trigger the supply disruption. On the other hand, the gold price depreciated by 0.61% to $1973.30 amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

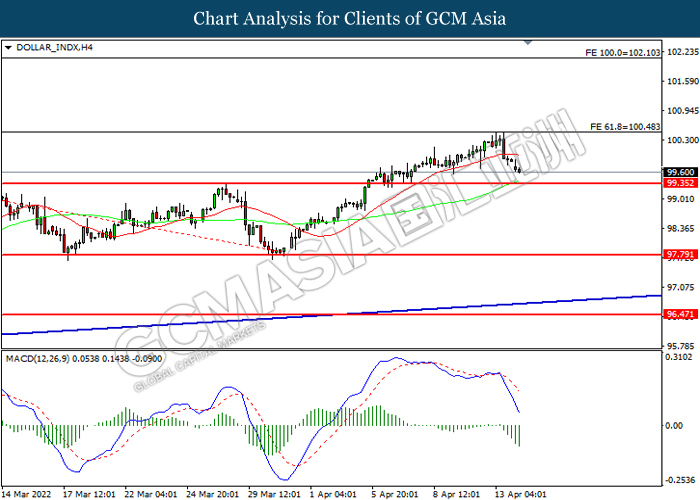

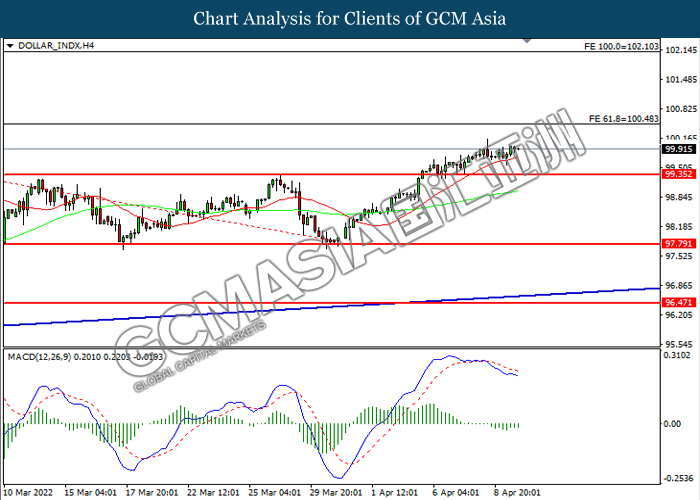

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

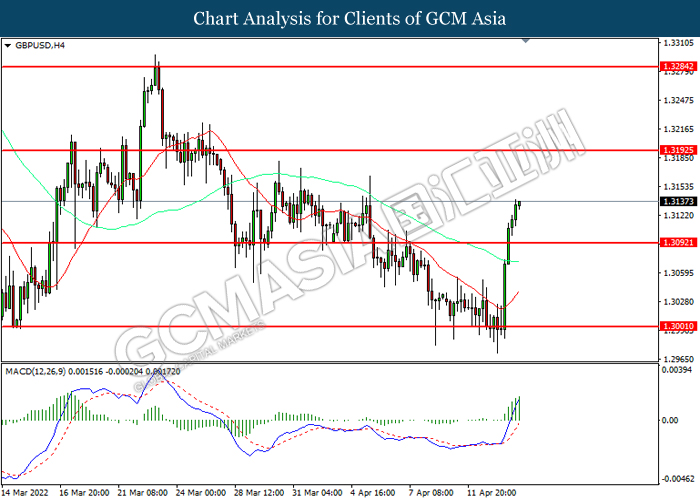

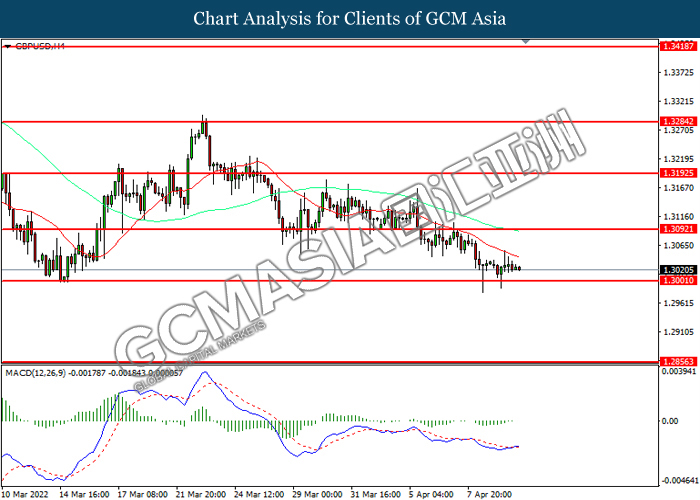

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.3065, 1.2995

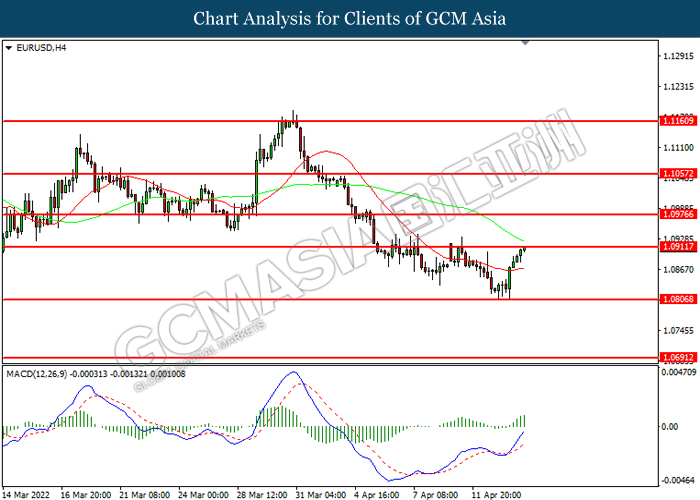

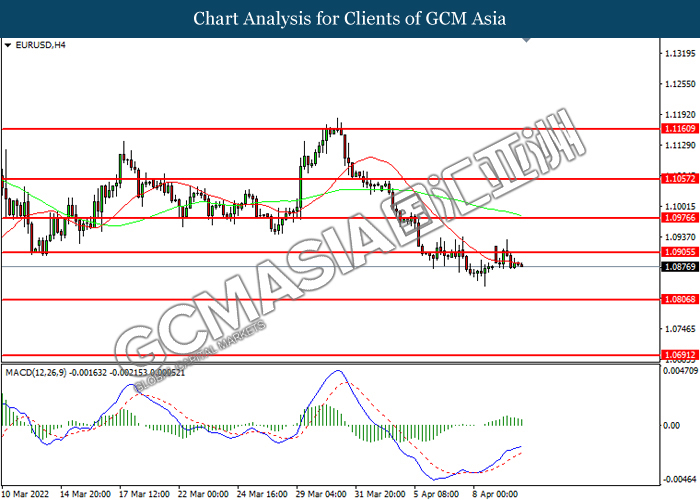

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0910, 1.0975

Support level: 1.0805, 1.0690

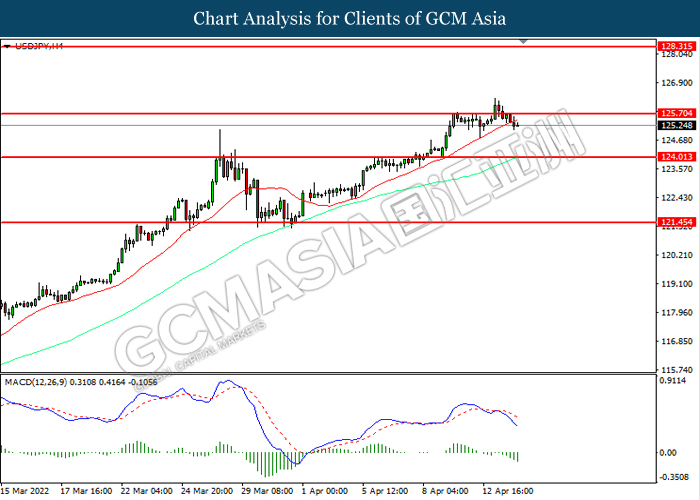

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 126.05, 128.30

Support level: 124.00, 121.45

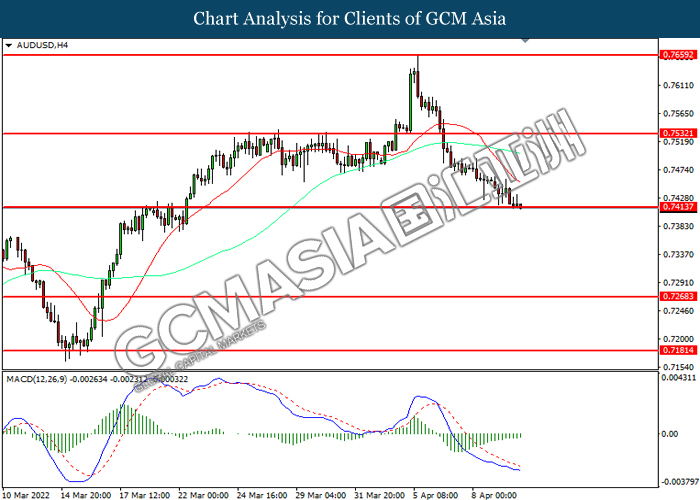

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7530, 0.7660

Support level: 0.7405, 0.7270

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6880, 0.6975

Support level: 0.6770, 0.6675

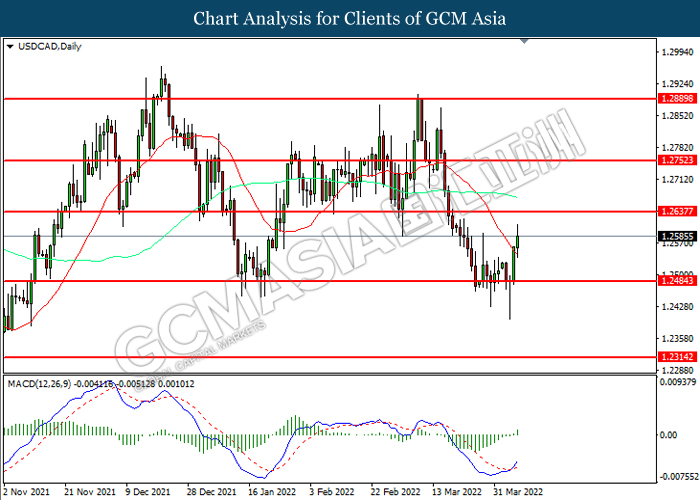

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

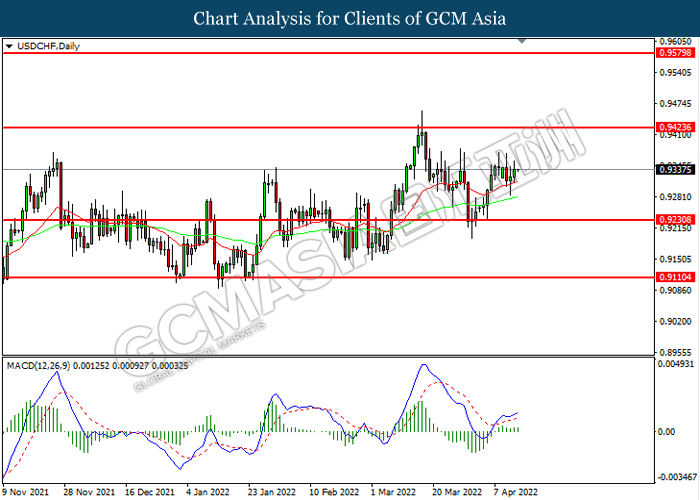

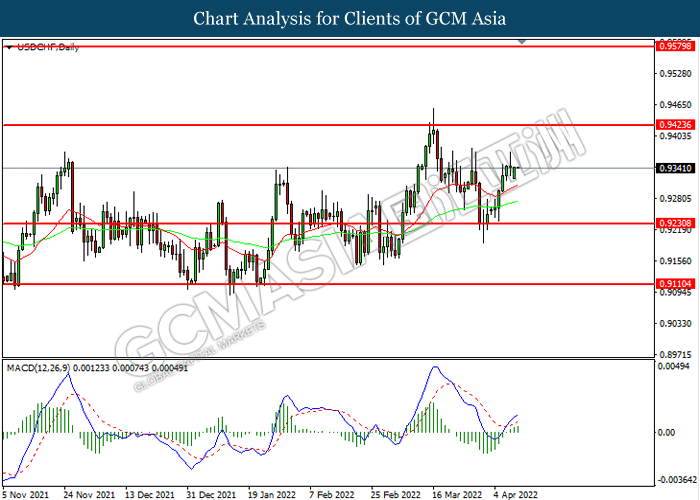

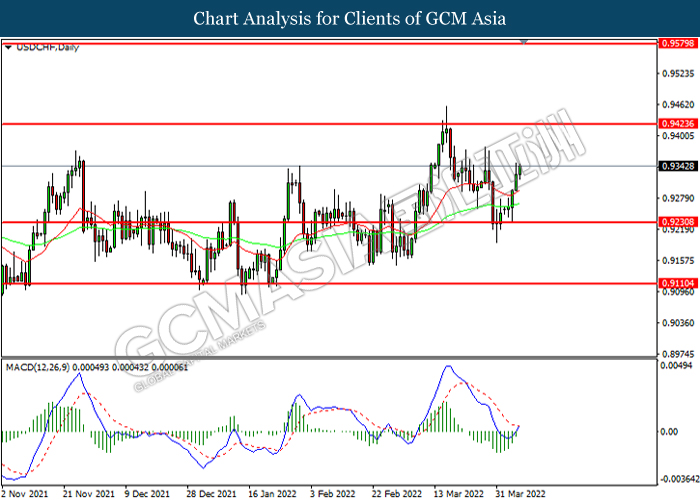

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

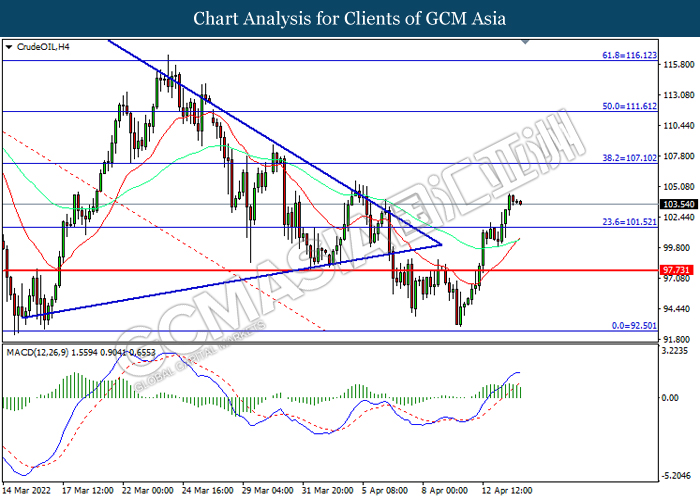

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

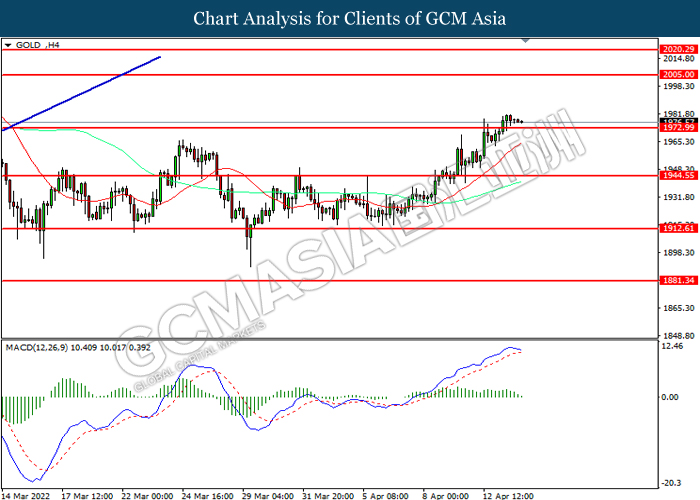

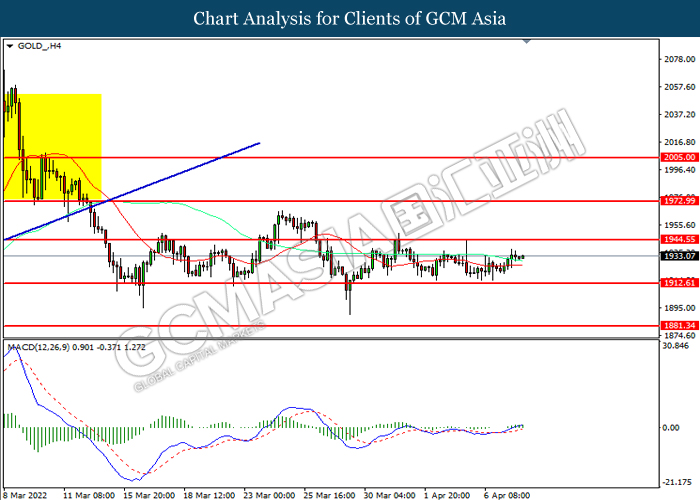

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.05, 2005.00

Support level: 1944.55, 1912.60

140422 Afternoon Session Analysis

14 April 2022 Afternoon Session Analysis

USDCAD eased amid rate hike from Bank of Canada.

USDCAD slumped from its recent high since Wednesday following the rate hike from Bank of Canada (BoC). According to Bank of Canada statement, Canada Interest Rate notched up from the previous reading of 0.50% to 1.00%, which fulfilled the market forecast of 1.00%. The Quantitative Tightening would begin on April 25. Besides, the BoC Governing Council judges that rates need to rise further and emphasizes that interest rates would be the bank’s primary tool for setting monetary policy. The BoC reiterated that they would guide the timing and pace of further rate hikes, as the BoC remains committed to achieving the 2% inflation target. The war-driven inflation risk had led to the spike of commodities price such as crude oil. Thus, BoC decided to increase interest rate in order to combat inflation risk by diminishing money circulation in the market. Rate hike from BoC would likely to bring positive prospects toward Canadian Dollar, prompting investors to shift their capitals towards Canadian Dollar. Investors would continue to scrutinize the latest updates with regards of interest rate decision from BoC in order to gauge the likelihood movement of the pair. As of writing, USDCAD depreciated by 0.13% to 1.2550.

In commodities market, crude oil price edged down by 0.82% to $103.39 per barrel as of writing following US Crude Oil Inventories came in at the reading of 9.382M, exceeding the previous reading of 2.421M and the market forecast of 0.863M. Besides, gold price depreciated by 0.33% to $19787.10 per troy ounces as of writing. Nonetheless, overall trend for gold price remained bullish over the backdrop of rising tension between Russia-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Apr) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Apr) | 0.00% | 0.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | 0.20% | 0.90% | – |

| 20:30 | USD – Initial Jobless Claims | 166K | 173K | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | 0.30% | 0.60% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3000

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0910, 1.0975

Support level: 1.0805, 1.0690

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it breakout the support level.

Resistance level: 2005.00, 2020.30

Support level: 1973.00, 1944.55

140422 Morning Session Analysis

14 April 2022 Morning Session Analysis

US Dollar hovered nearby recent high, eyed on FOMC monetary decision.

The Dollar Index which traded against a basket of six major currencies retreated from its recent high, which mostly caused by technical correction and profit taking from investors. Though, the overall trend for the US Dollar still remained bullish as spiking number of inflation rate had sparked hopes upon the contractionary monetary policy in future. According to US Bureau of Labor Statistics, US Producer Price Index (PPI) notched up significantly from the previous reading of 0.9% to 1.4%, exceeding the market forecast at 1.1%. On a yearly basis, the data climbed 11.2% compared to a year ago. PPI is considered a forward-looking inflation indicator as it tracks prices in the pipeline for good and services that eventually reach consumers. As for now, market participants are pricing in an almost certainty that the central bank will increase their interest rate by 50 basis point during the next monetary policy meeting. As for now, the Dollar Index depreciated by 0.44% to 99.85.

In the commodities market, the crude oil price extends its gains by 0.01% to $104.55 per barrel as of writing. The oil market surged over the backdrop of rising tensions between Russia-Ukraine continue to spur bullish momentum on the crude oil price. On the other hand, the gold price appreciated by 0.01% to $1978.25 per troy ounces as of writing amid bullish number of inflation data across the US and EU region had increased the appeal for the inflation-hedging commodities such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Apr) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Apr) | 0.00% | 0.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | 0.20% | 0.90% | – |

| 20:30 | USD – Initial Jobless Claims | 166K | 173K | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | 0.30% | 0.60% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3000

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0905, 1.0975

Support level: 1.0805, 1.0690

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6800, 0.6880

Support level: 0.6730, 0.6625

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses/

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 2005.00, 2020.30

Support level: 1973.00, 1944.55

130422 Afternoon Session Analysis

13 April 2022 Afternoon Session Analysis

Euro slumped amid Russia invasion of Ukraine.

Euro extend its losses since yesterday over the backdrop of rising tension between Russia-Ukraine. According to Reuters, President Vladimir Putin appeared a speech on Tuesday, which claimed that the peace talks with Ukraine had hit a dead end, using his first public comments on the conflict in more than a week to vow his troops would win and to goad the West for failing to bring Moscow to heel. Russia invasion of Ukraine would lead to the disruption of global supply chain, including commodities market, causing the commodities price such as crude oil to spike. The surge of crude oil price would bring negative prospects toward economic progression in Europe region by increasing the import cost of companies, dialing down the market optimism toward economic prospects in Europe. It prompted investors to shift their capitals toward other currencies such as US Dollar. Besides, the chairmen of three parliamentarian committees said on Tuesday after a visit to Ukraine, claimed that the European Union should impose an embargo on Russian oil as soon as possible, according to Reuters. The implementation of embargo on Russian oil would likely to diminish oil circulation in the market, spurring further bearish momentum on Euro. As of writing, EURUSD appreciated by 0.12% to 1.0839.

In commodities market, crude oil price surged by 0.23% to $100.83 per barrel as of writing following the war-driven oil supply disruption. On the other hand, gold price depreciated by 0.26% to $1971.00 per troy ounces as of writing. Nonetheless, the overall trend of gold price remained bullish amid the backdrop of rising tension between Russia-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 6.20% | 6.70% | – |

| 20:30 | USD – PPI (MoM) (Mar) | 0.80% | 1.10% | – |

| 22:00 | CAD – BoC Monetary Policy Report | – | – | – |

| 22:00 | CAD – BoC Interest Rate Decision | 0.50% | 1.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.421M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3010, 1.3090

Support level: 1.2930, 1.2845

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0955, 1.1080

Support level: 1.0795, 1.0685

USDJPY, H1: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.65, 126.10

Support level: 125.20, 124.60

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7480, 0.7535

Support level: 0.7410, 0.7365

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6890, 0.6980

Support level: 0.6800, 0.6740

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2660, 1.2700

Support level: 1.2605, 1.2550

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 103.75, 108.40

Support level: 98.55, 93.65

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1974.45, 1988.50

Support level: 1961.25, 1948.15

130422 Morning Session Analysis

13 April 2022 Morning Session Analysis

US Dollar extend its gains as rising inflation rate triggered rate hike expectation.

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of spiking inflation data yesterday, raising probability for rate hike from Federal Reserve while sending the US 10-Year Treasury note to hover at recent high. According to US Bureau of Labor Statistics, the US Consumer Price Index (CPI) climbed at their highest rates since 1981, increasing 8.5% over the year to the end of March as rising tensions between Russia-Ukraine continue to drive up energy costs. Besides, the Federal Reserve Governor Lael Brainard claimed that the Federal Reserve would likely to conduct a series of rate hikes and begin to reduce its massive bond buying program as soon as June to combat the high inflation rate. As of writing, the Dollar Index appreciated by 0.38% to 100.31.

In the commodities market, the crude oil price appreciated by 0.44% to $102.00 per barrel as of writing. The oil market edged higher as the Chinese authorities had eased the Covid-19 restriction in China. On the other hand, the gold price appreciated by 0.04% to $1965.57 per troy ounces as of writing as investors shift their portfolio toward safe-haven gold to hedge against the inflation risk in future.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 6.20% | 6.70% | – |

| 20:30 | USD – PPI (MoM) (Mar) | 0.80% | 1.10% | – |

| 22:00 | CAD – BoC Monetary Policy Report | – | – | – |

| 22:00 | CAD – BoC Interest Rate Decision | 0.50% | 1.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.421M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 101.50. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 101.50, 107.10

Support level: 97.75, 92.50

GOLD_, H4: Gold price was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60

120422 Afternoon Session Analysis

12 April 2022 Afternoon Session Analysis

Pound edged down amid downbeat economic data.

GBPUSD has been dragged down since yesterday over the backdrop of passive economic data. According to Office for National Statistics, UK Gross Domestic Product (GDP) MoM notched down from the previous reading of 0.8% to 0.1%, which lower than the market forecast of 0.3%. Besides, UK Manufacturing Production MoM recorded at the reading of -0.4%, worst than the previous reading of 0.9% and the market forecast of 0.3%. Both downbeat economic data has indicated that the UK economic prospects are not as good as they once were. It dialed down the market optimism toward economic progression in UK region, prompting investors to selloff Pound. On the other hand, the US Dollar Index was back above 100 on Tuesday morning, supported by high U.S. yields ahead of inflation data that is expected to show US prices gained the most in over 16 years, reinforcing expectations of aggressive Fed tightening policy. The rate hike expectation from Federal Reserve had stoked a shift sentiment toward US Dollar which having better prospects, spurring further bearish momentum on the Pound. As of writing, GBPUSD depreciated by 0.05% to 1.3022.

In commodities market, crude oil price appreciated by 2.10% to $96.28 per barrel as of writing following the market weighed the potential for more sanctions on Russia’s energy sector and OPEC warned it would be impossible to increase output enough to offset lost supply. Besides, gold price appreciated by 0.49% to $1957.50 per troy ounces as of writing amid the rising tension between Russia-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 4.80% | – | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -48.1K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | -39.3 | -48 | – |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level at 92.50. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60

120422 Morning Session Analysis

12 April 2022 Morning Session Analysis

US Treasury yield hit recent high, Dollar received bullish momentum.

The Dollar Index which traded against a basket of six major currencies extend its gains, buoyed by continued rising of US Treasury yield. In earlier, St. Louis Fed President James Bullard stated that the central bank needs to increase their interest rates by another 3% by year end. The benchmark 10-year Treasury yield rose significantly to 2.77%. Recently, the Treasury yields have been on extend its bullish trend recently, with concerns that the rising inflation rate would prompt the Federal Reserve to announce a more aggressive contractionary monetary policy. Market participants have raced to price in the risk of larger rate hike from Federal Reserve with implying the rises of 50 basis point during both May and June monetary meeting. As of writing, the Dollar Index appreciated by 0.18% to 99.97.

In the commodities market, the crude oil price depreciated by 3.74% to 94.90 per barrel as of writing. The oil market extends its losses following the European Union officials claimed that they will hold a talk in Vienna with OPEC representative to discuss about the oil output plan. On the other hand, the gold price appreciated by 0.13% to $1949.95 per troy ounces as of writing amid risk-off sentiment in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 4.80% | – | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -48.1K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | -39.3 | -48 | – |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H1: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level at 92.50. MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60

110422 Afternoon Session Analysis

11 April 2022 Afternoon Session Analysis

Australia Dollar slumped as bearish economic prospect in China.

The Chinese proxy currency such as Australia Dollar slumped significantly over the backdrop of bearish economic data from China. The China’s factory inflation slowed but exceed expectations in March as country still suffered with cost pressures following the rising tensions between Russia-Ukraine continue to affect the global supply chain issues. According to National Bureau of Statistics, China Producer Price Index (PPI) for last quarter notched down significantly from the previous reading of 8.8% to 8.3%, exceeding the market forecast at 7.9%. Besides, the overall economic prospect on China remained negative following the rising Covid-19 cases in the country. According to latest statistics, China reported almost more than 24,000 Covid-19 cases over the previous 24 hours. The implementation of lockdown policies would likely to trigger stagflation risk in future, dialling down the market optimism toward the Chinese’s major export countries such as Australia. As of writing, AUD/USD depreciated by 0.20% to 0.7440.

In the commodities market, the crude oil price slumped 2.13% to $96.55 per barrel as of writing. The oil price extends its losses amid the rising tensions between Russia-Ukraine as European countries would likely to discuss the implementation of oil sanction toward Russia. Investors would continue to scrutinize the latest updates with regards of the Russia-Ukraine tensions to receive further trading signal. On the other hand, the gold price appreciated by 0.04% to $1944.55 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | 0.80% | – | – |

| 14:00 | GBP – GDP (YoY) | 6.60% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Feb) | 0.80% | 0.30% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 1.10% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H1: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 125.05, 126.15

Support level: 124.35, 123.25

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

USDCAD, Daily: USDCAD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

110422 Morning Session Analysis

11 April 2022 Morning Session Analysis

US Dollar surged amid diminishing risk appetite in the global market.

The Dollar index which traded a basket of six major currencies extend its gains over the backdrop of risk-off sentiment in the global financial market following the rising tensions Russian-Ukraine. According to Reuters, Ukraine claimed on Sunday that currently they were seeking for another round of European Union sanctions against Russia and more military support from its allies in order to combat the Russian military in the east of the country. Massive civilian casualties following hundreds of deaths in the town of Bucha have triggered widespread of international condemnation and new sanctions. As for now, top EU officials, Austrian Chancellor Karl Nehammer and British Prime Minister Boris Johnson had also pledged of another more military and financial aid and new sanctions for Ukraine. As for now, investors would continue to scrutinize the latest development with regards of the tensions between Russia-Ukraine to receive further trading signal. As of writing, the Dollar Index appreciated by 0.09% to 99.84.

In the commodities market, the crude oil price appreciated by 0.69% to 98.60 per barrel as of writing. The oil market edged higher as market participants concerned that the implementation of oil and gas sanction from European countries to Russia would likely to disrupt oil supply in future. On the other hand, the gold market surged 0.81% to $1947.45 per troy ounces as of writing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | 0.80% | – | – |

| 14:00 | GBP – GDP (YoY) | 6.60% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Feb) | 0.80% | 0.30% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 1.10% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 124.35, 126.15

Support level: 123.25, 121.45

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

USDCAD, H4: USDCAD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

080422 Afternoon Session Analysis

8 April 2022 Afternoon Session Analysis

Euro slumped amid Russia-Ukraine issue intensified.

EURUSD extend its losses on Friday amid the backdrop of expectations of escalation in the Ukraine crisis after Russia ceases to be a member of the United Nations (UN) Human Rights Council. According to Reuters, the members of the UN Human Rights Council voted in favor of stripping Russia from the members’ list after the Russian rebels committed war crimes in Bucha, Ukraine. As world nations are isolating Russia from major communities, Russian leader Vladimir Putin could de-escalate progress talks with Ukraine, and the Ukraine crisis may continue to elevate further. The move of Russia would likely to cause another aggressive sanctions on it. It would likely to bring negative prospects toward economic progression in Europe region as Russia was one of the trading partner for Europe, dialing down the market optimism toward Euro. It prompted investors to selloff Euro and shift their capital toward the currencies which having better prospects such as US Dollar. As of writing, EURUSD depreciated by 0.18% to 1.0858.

In commodities market, crude oil price eased by 0.55% to $95.51 per barrel as of writing over the backdrop of consuming countries agreed to release 240 million barrels of oil from emergency stocks to help offset disrupted Russian supply. Besides, gold price depreciated 0.47% to $1928.75 per troy ounces as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Mar) | 336.6K | 80.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullsih momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0955, 1.1080

Support level: 1.0795, 1.0685

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7480, 0.7535

Support level: 0.7410, 0.7365

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6890, 0.6980

Support level: 0.6800, 0.6740

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2605, 1.2660

Support level: 1.2550, 1.2475

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 98.55, 103.75

Support level: 93.65, 89.35

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1937.50, 1948.15

Support level: 1917.55, 1904.80

080422 Morning Session Analysis

8 April 2022 Morning Session Analysis

US 10-year yield hit its highest level in three years, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies received significant bullish momentum following the US 10-year Treasury yield hit its highest level since March 2019 on Thursday as investors continued to speculated that latest hawkish tone from the Federal Reserve. The US 10-year treasury yield hitting 2.667%. According to the latest statistic, the CME FedWatch Tool was assigning a probability of 78.8% to a 50-basis point rate hike during the May FOMC meeting. In earlier, the meeting minutes released from the Fed’s March meeting suggested the Federal Reserve should reduce their liabilities in balance sheet next month while increasing the interest rate in order to combat the high inflation risk in future. As of writing, the Dollar Index appreciated by 0.15% to 99.75.

In the commodities market, the crude oil price depreciated by 0.45% to $96.70 per barrel as of writing. The oil market edged lower amid investors remained their doubts upon whether the European leaders will be able to effectively sanction Russian energy exports. On the other hand, the gold price surged 0.04% to $1932.45 per troy ounces as of writing as market participants concerned that the implementation of sanction on Russia would likely to trigger future inflation risk, prompting investors to shift their portfolio toward safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Mar) | 336.6K | 80.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACFD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.10, 125.55

Support level: 121.30, 118.95

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6880. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6975, 0.7045

Support level: 0.6880, 0.6800

USDCAD, Daily: USDCAD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

070422 Afternoon Session Analysis

7 April 2022 Afternoon Session Analysis

Australia Dollar eased following possibility of sanction on China.

The AUDUSD extend its losses on Thursday amid the backdrop of market speculated US might impose sanctions upon China. According to Reuters, US Deputy Secretary of State Wendy Sherman has claimed that China would likely to face sanctions if China provide its supports to Russia. She also reiterated that sanctions imposed on Russia over its war in Ukraine should give China a “good understanding” of the consequences it could face if it provides material support to Moscow. As the sanctions was imposed to China, it would bring negative prospects toward economic progression in China region. Indirectly, the economic momentum of Australia would be dragged down as China was the largest trading partner for Australia. It dialed down the market optimism toward Australia Dollar. Besides, in a major test of China’s zero-tolerance strategy to eliminate the novel coronavirus, the China government widened the lockdown to eastern parts of the city and extended until further notice restrictions in western districts, which had been due to expire on Tuesday, according to Reuters, spurring further bearish momentum on the Australia Dollar. Investors would continue to scrutinize the latest update with regards of the sanction decision upon Russia in order to gauge the likelihood movement of the pair. As of writing, AUDUSD depreciated by 0.33% to 0.7488.

In commodities market, crude oil price appreciated by 1.66% to $97.83 per barrel as of writing. Nonetheless, the overall trend for oil price remained bearish following oil release from IEA. On the other hand, gold price edged up by 0.09% to 1924.90 per troy ounces as of writing. However, gold price still under pressure over the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 202K | 200K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0955, 1.1025

Support level: 1.0890, 1.0795

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7485, 0.7545

Support level: 0.7415, 0.7365

NZDUSD, H4: NZDUSD was traded lower following while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses id successfully breakout the support level.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 98.55, 103.75

Support level: 93.65, 89.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1937.50, 1948.15

Support level: 1917.55, 1904.80

070422 Morning Session Analysis

7 April 2022 Morning Session Analysis

FOMC meeting minutes signalled hawkish tone, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of hawkish expectation from Federal Reserve following the minutes of the previous Federal Reserve meeting reinforced the probability of multiple half percentage-point rate hike to combat the inflation rate. According to FOMC meeting minutes, the Fed officials viewed the 50-basis point of rate hike as appropriate during the next monetary policy meeting if the inflation pressures continue to intensify. Besides, the Monetary Policy Committee (MPC) also agreed to reduce the debt in balance sheet by $95 million per month with $60 billion of its Treasury holdings and $35 billion of mortgage-backed securities over the next three months. The contractionary monetary policy from Fed would likely to diminish the money circulation in the financial market, spurring bullish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.15% to 99.65.

In the commodities market, the crude oil price slumped 0.15% to $97.25 per barrel as of writing following the bearish inventory was released. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at 2.421M, exceeding the market forecast at -2.056M. On the other hand, the gold price depreciated by 0.11% to $1923.20 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 202K | 200K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0970, 1.1135

Support level: 1.0895, 1.0825

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACFD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.00, 125.55

Support level: 121.30, 118.95

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6900. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

USDCAD, Daily: USDCAD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

060422 Afternoon Session Analysis

6 April 2022 Afternoon Session Analysis

Australia Dollar spiked following tightening monetary policy.

The Australia Dollar surged on yesterday amid the backdrop of tightening monetary policy from Australia’s central bank. According to Reuters, Australia’s central bank had claimed on Tuesday that it opened the door to the first interest rate increase in more than a decade as it dropped a previous pledge to be “patient” on policy, a major surprise that sent the local dollar to nine-month highs. The rate hike decision from Australia’s central bank would likely to diminish the money circulation in the market, dialing up the market optimism toward Australia Dollar. Nonetheless, the gains of the pair was limited following whole of Shanghai entered lockdown. In a major test of China’s zero-tolerance strategy to eliminate the novel coronavirus, the government widened the lockdown to eastern parts of the city and extended until further notice restrictions in western districts, which had been due to expire on Tuesday. As China was the largest trading partner for Australia, lockdown of China region would likely to bring negative prospects toward economic progression in Australia, prompting investors to selloff Australia Dollar and purchase other currencies which having better prospects. As of writing, AUDUSD depreciated by 0.13% to 0.7570.

In commodities market, crude oil price depreciated by 0.26% to $101.69 per barrel as of writing. However, the overall trend for crude oil price was remained bullish over the backdrop of new sanction on Russia from US and Europe. On the other hand, gold price depreciated by 0.23% to $1923.00 per troy ounces as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Mar) | 59.1 | 57.3 | – |

| 22:00 | CAD – Ivey PMI (Mar) | 60.6 | – | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.449M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0955, 1.1025

Support level: 1.0890, 1.0795

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resstance level.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7595, 0.7650

Support level: 0.7545, 0.7485

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 103.75, 108.40

Support level: 98.55, 93.65

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1948.15, 1990.10

Support level: 1912.05, 1880.20