060422 Morning Session Analysis

6 April 2022 Morning Session Analysis

Rate hike expectation hovered in market, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies surged into its highest level in nearly two years following the Federal Reserve unleashed their hawkish tone toward the economic progression in the United States by impressing openness to hefty rate increases of half a percentage point. According to Reuters, Fed Governor Lael Brainard, usually one of the Fed’s dovish policymakers, claimed that she expected the Federal Reserve would increase the interest rate significantly and a rapid reduction on their bond purchasing program to stabilize the Fed balance sheet. She also reiterated that further contractionary monetary policy is needed in order to combat the spiking inflation risk in future. Besides, Kansas City Fed President Esther George also remarks on Tuesday that he claimed that she would support a 50-basis point of rate hike to reduce the size of the Fed’s nearly $9 trillion balance sheet in debt. As of writing, the Dollar Index appreciated by 0.49% to 99.48.

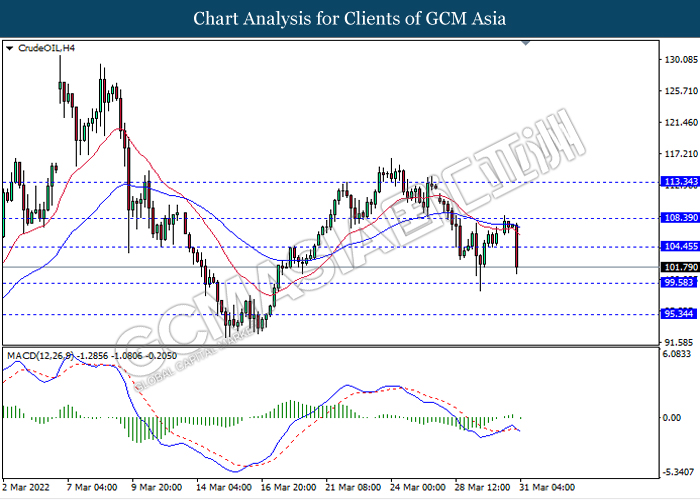

In the commodities market, the crude oil price slumped 0.40% to $101.75 per barrel as of writing. The oil market edged lower over the backdrop of downbeat inventory data. According to American Petroleum Institute, US API Weekly Crude Oil stock came in at 1.080M, higher than the market forecast at -1.558M. On the other hand, the gold price depreciated by 0.08% to $1921.90 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Mar) | 59.1 | 57.3 | – |

| 22:00 | CAD – Ivey PMI (Mar) | 60.6 | – | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.449M | – | – |

Technical Analysis

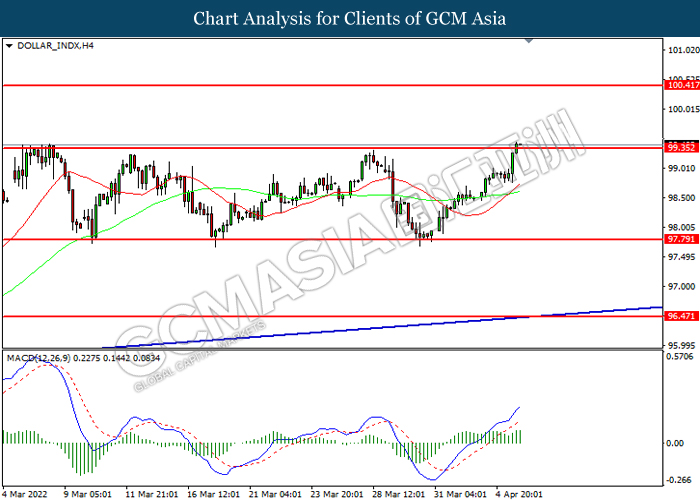

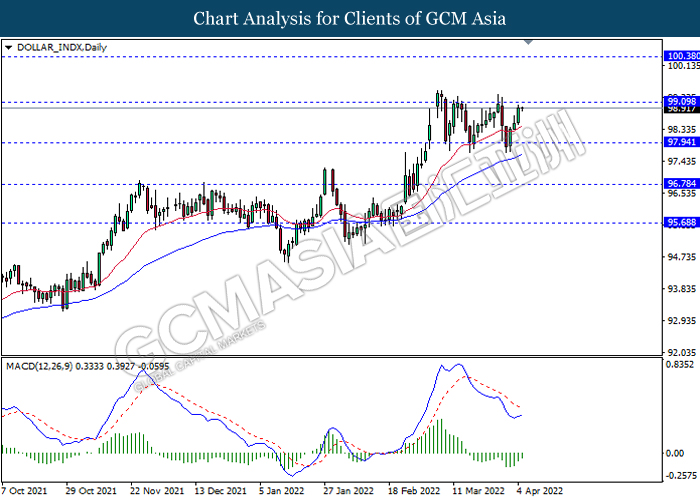

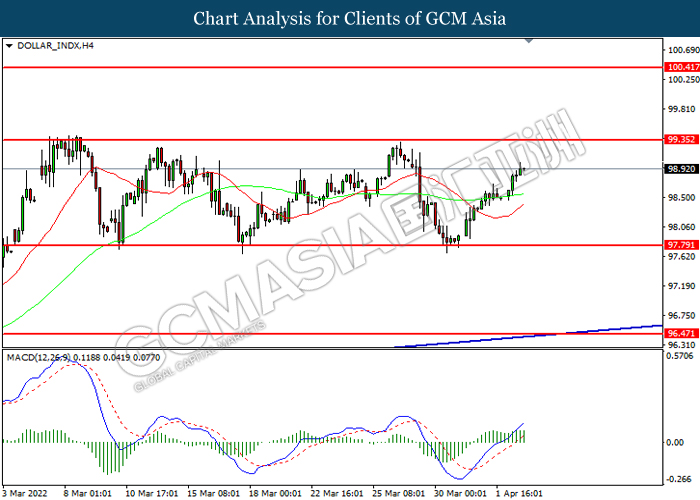

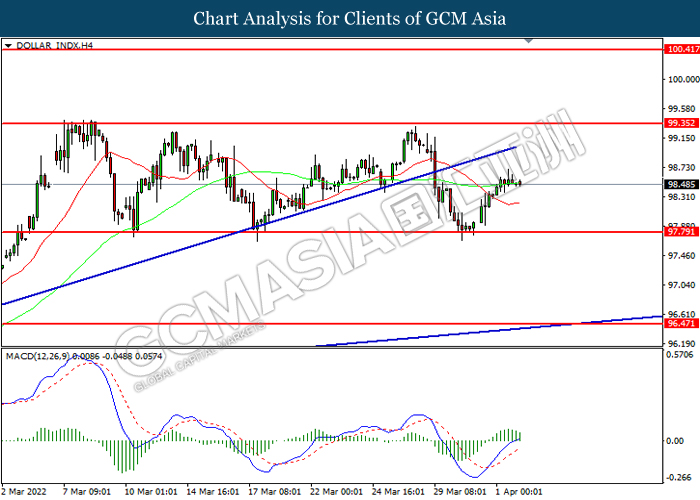

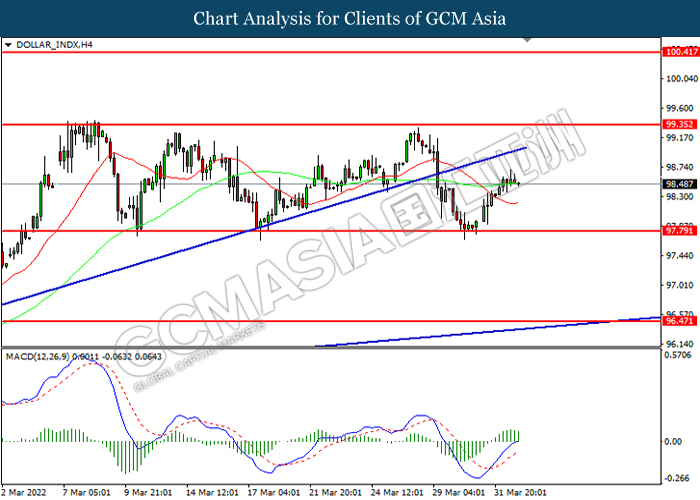

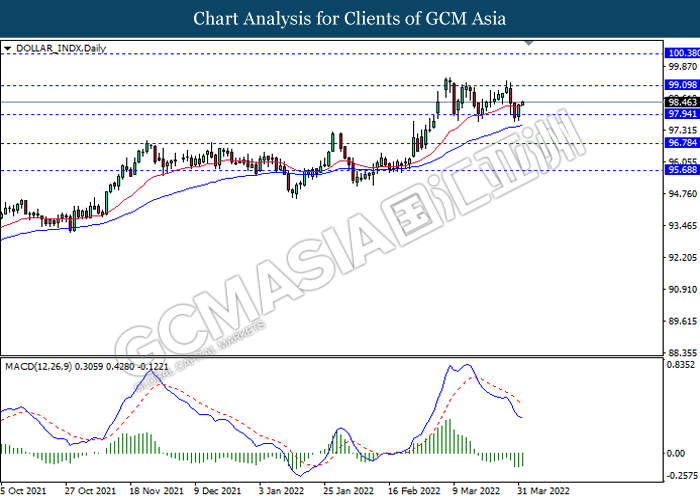

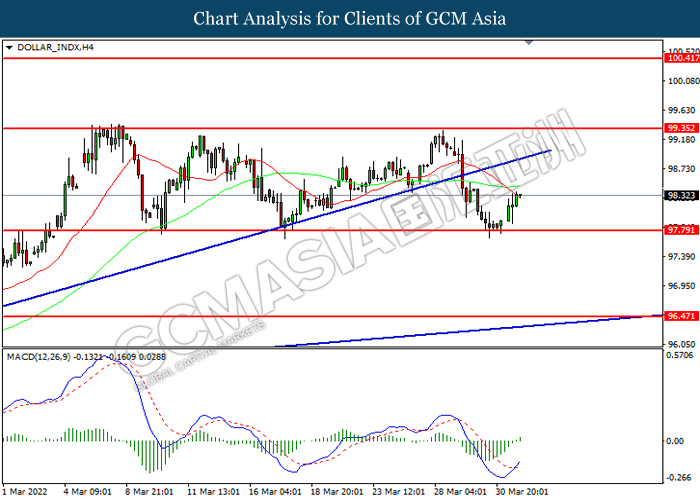

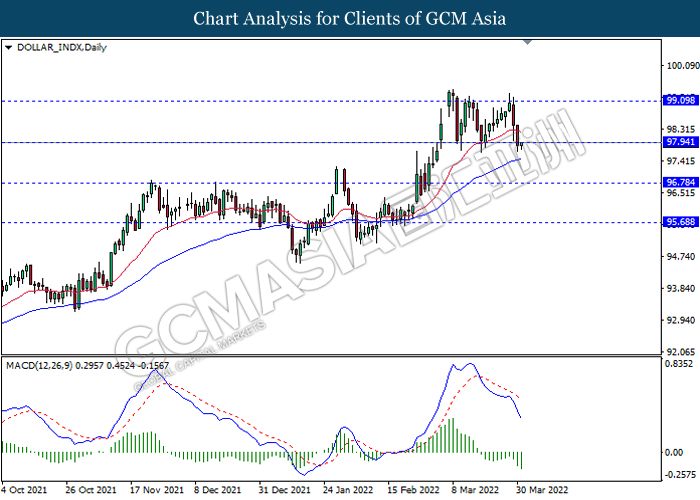

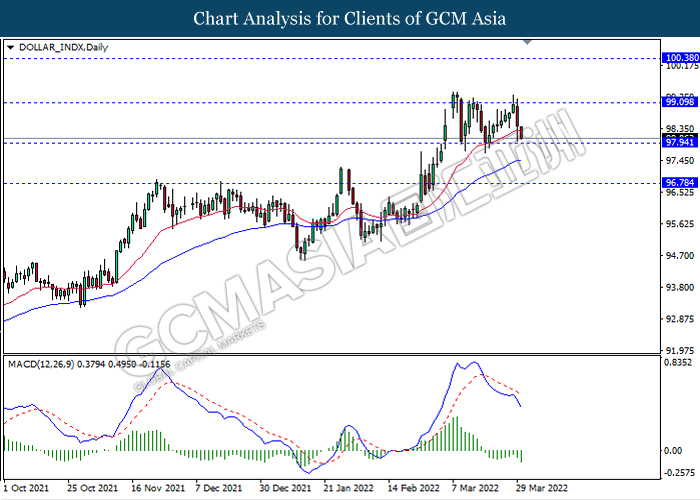

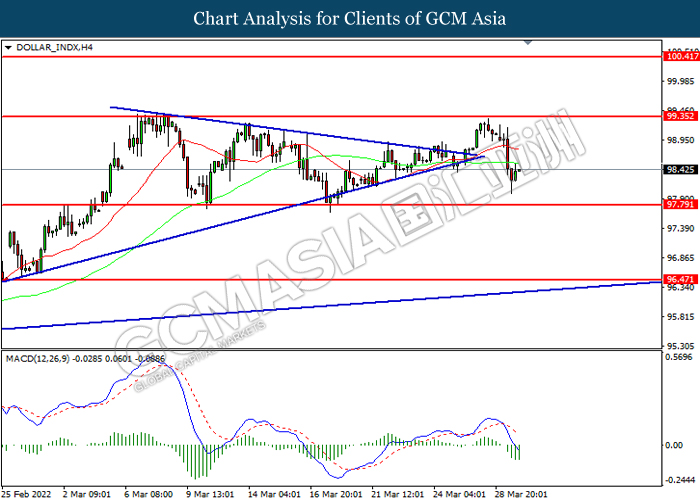

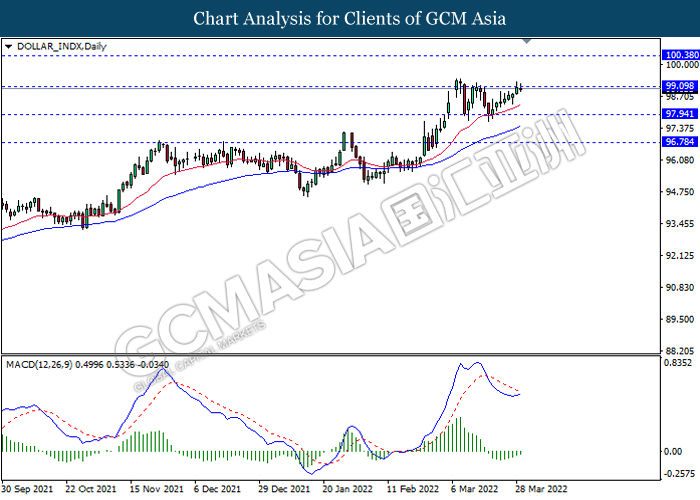

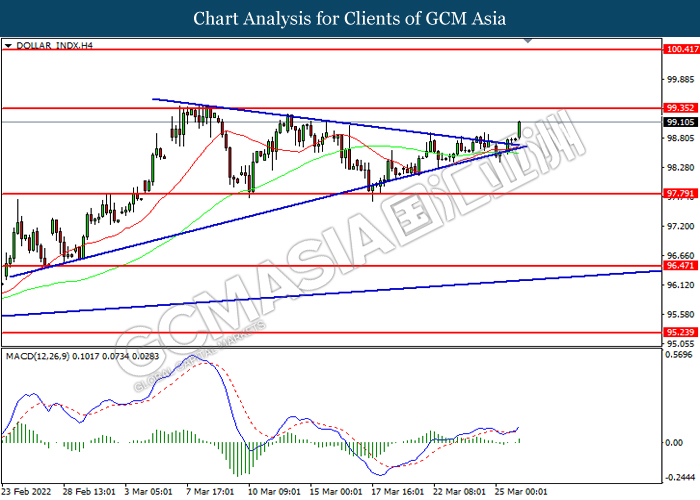

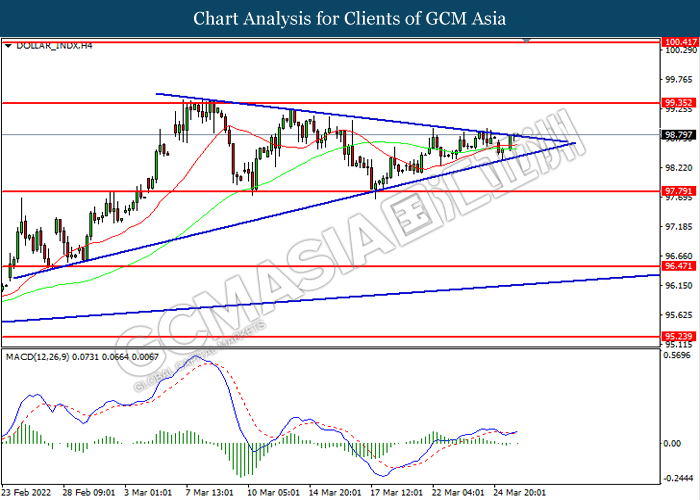

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

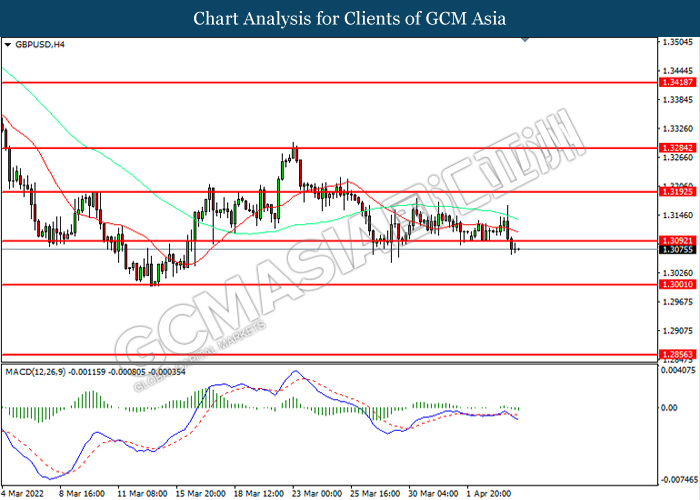

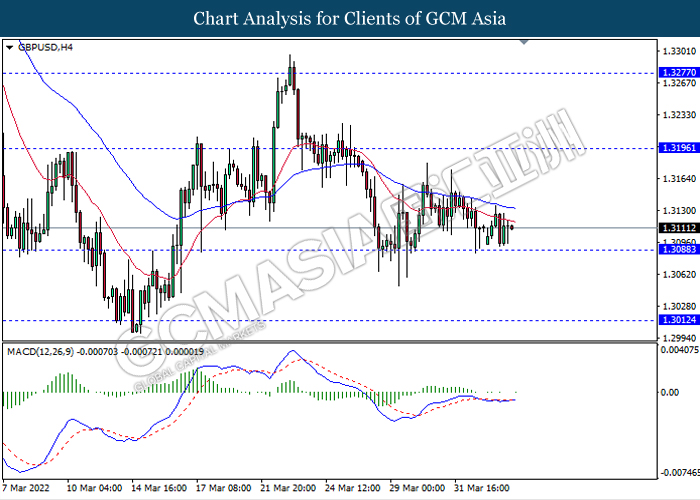

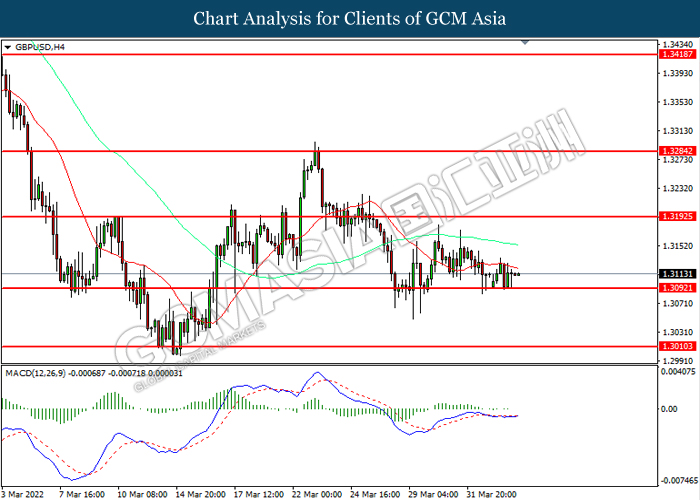

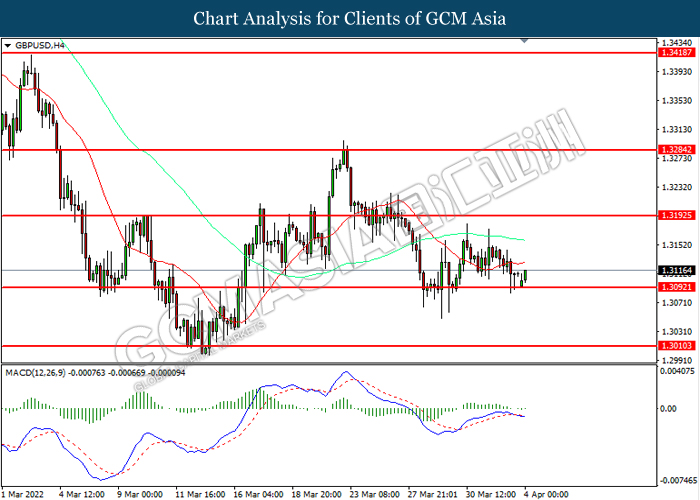

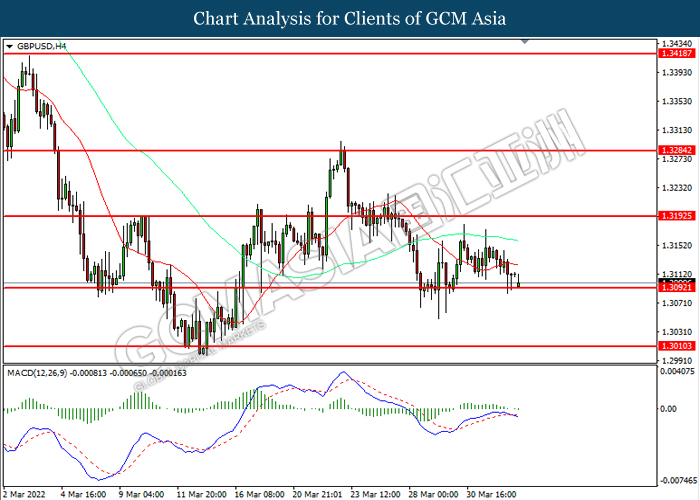

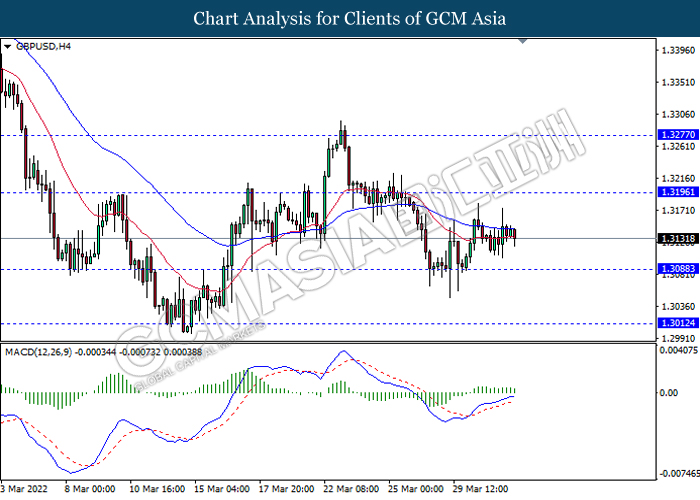

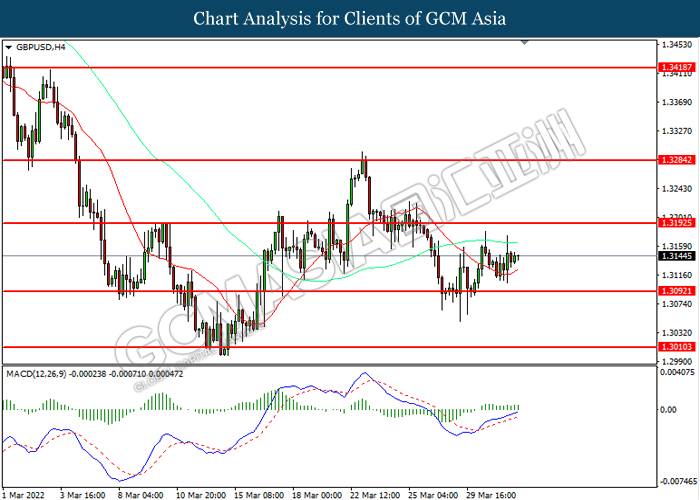

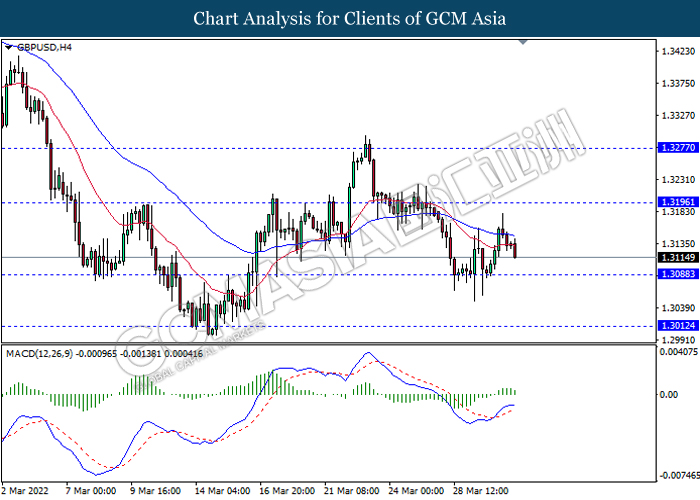

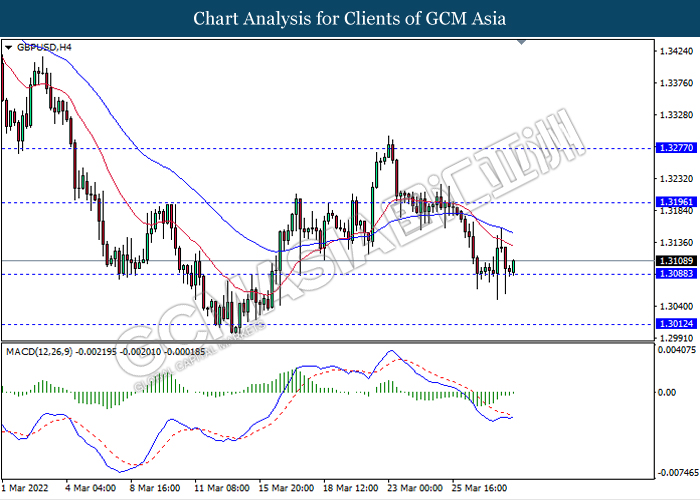

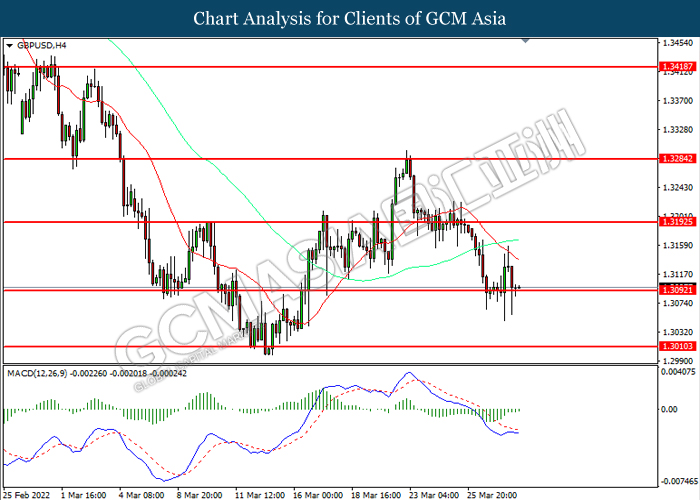

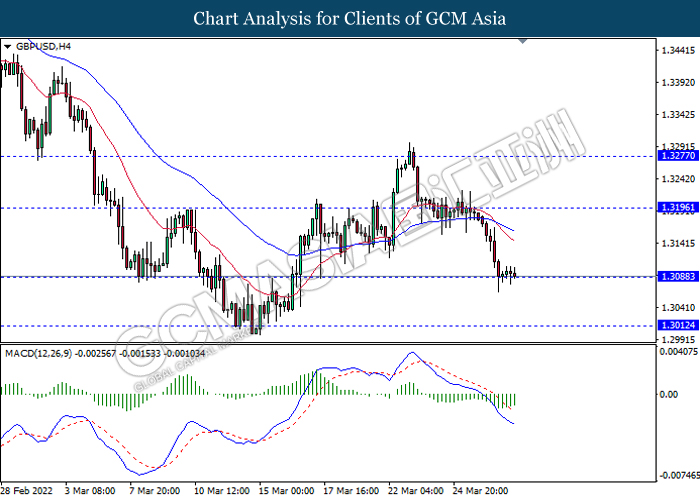

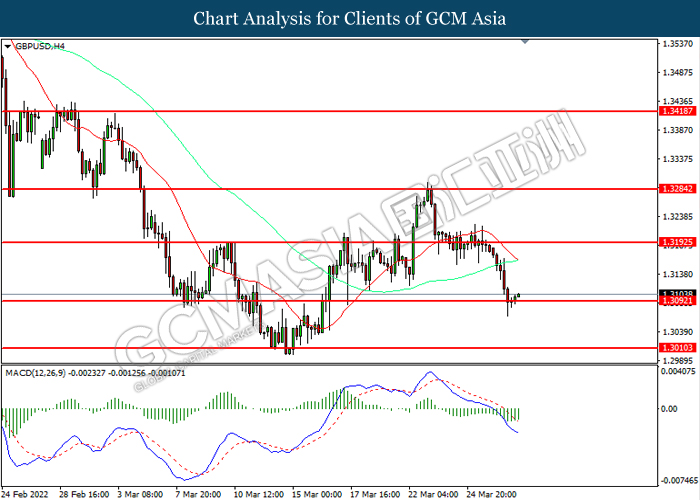

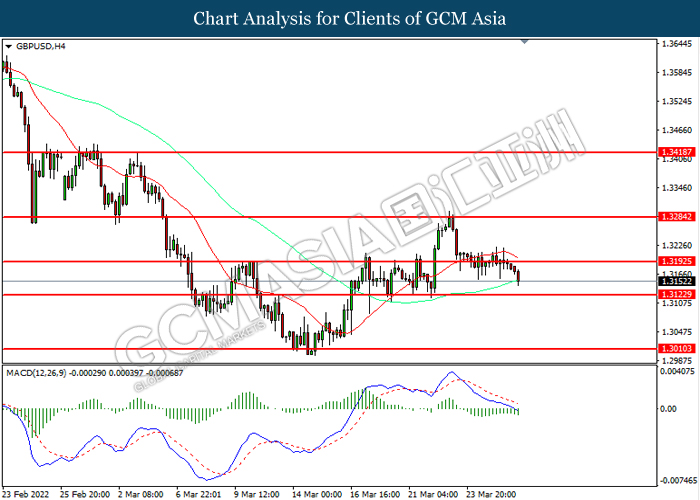

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

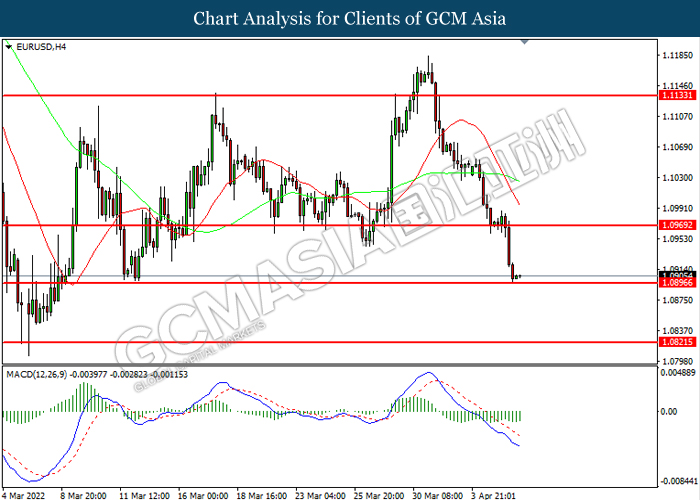

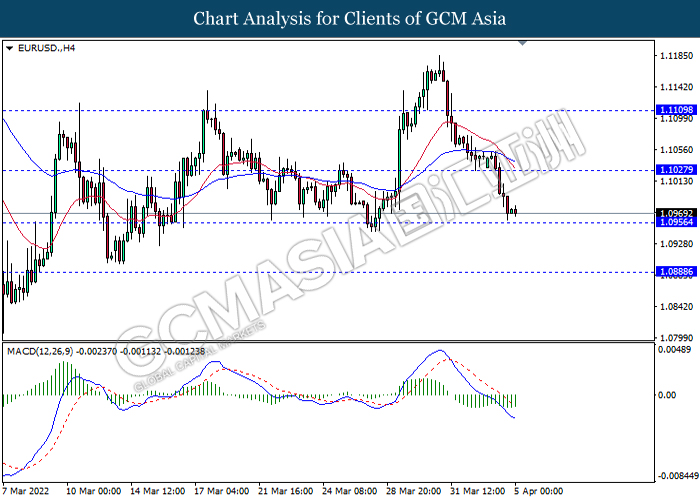

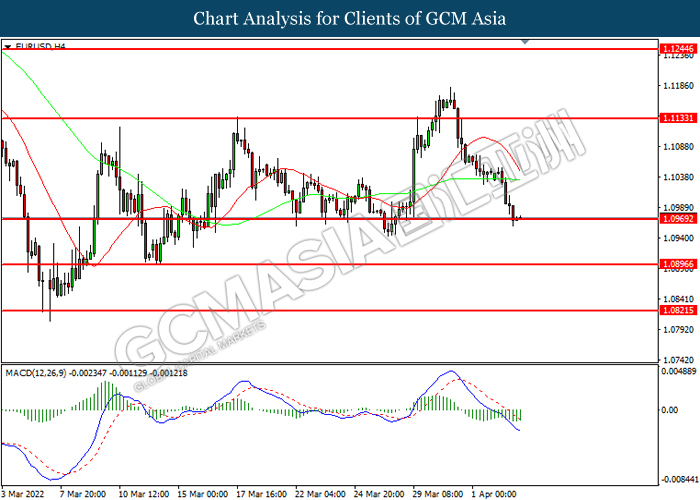

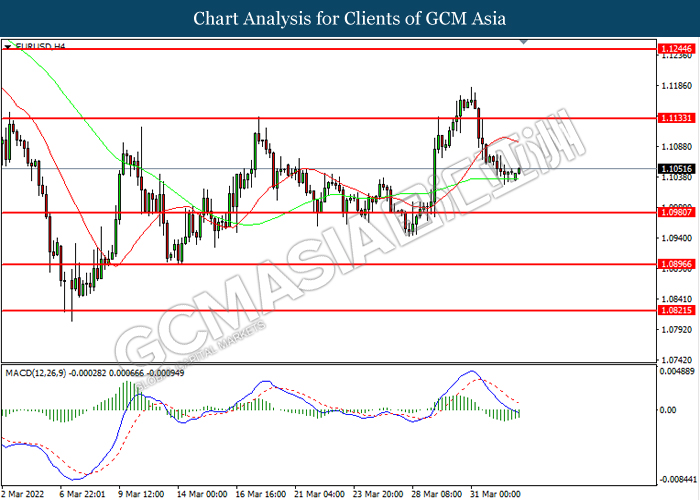

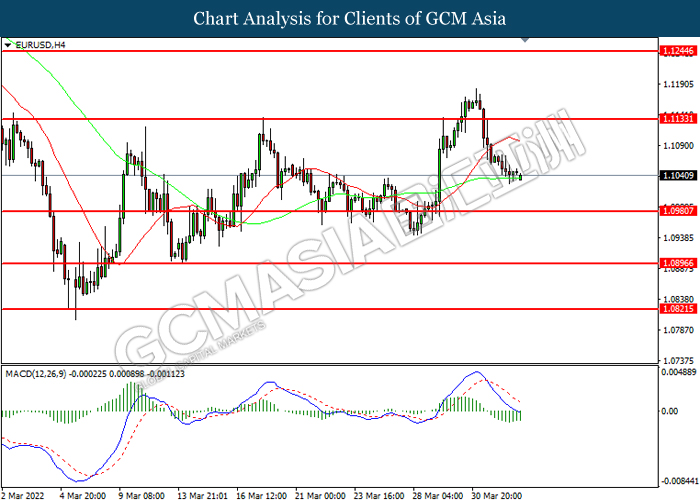

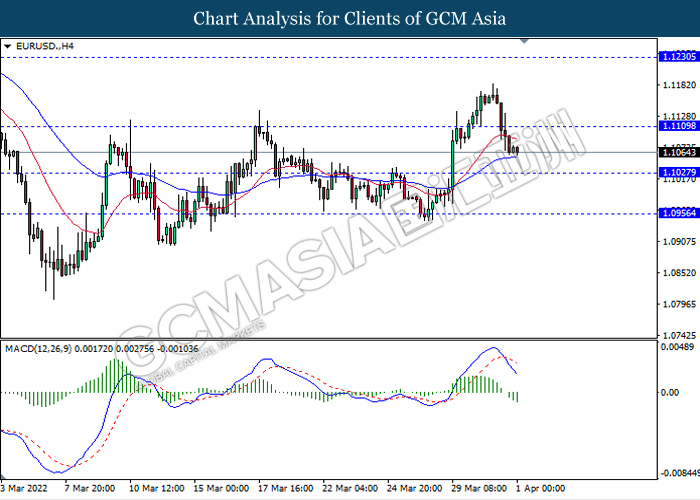

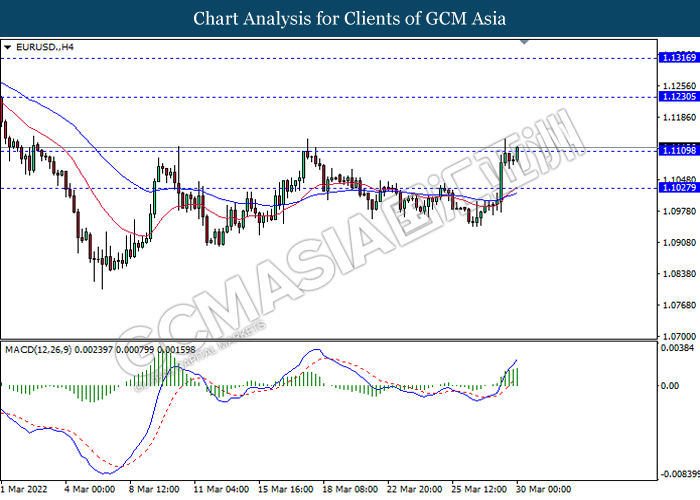

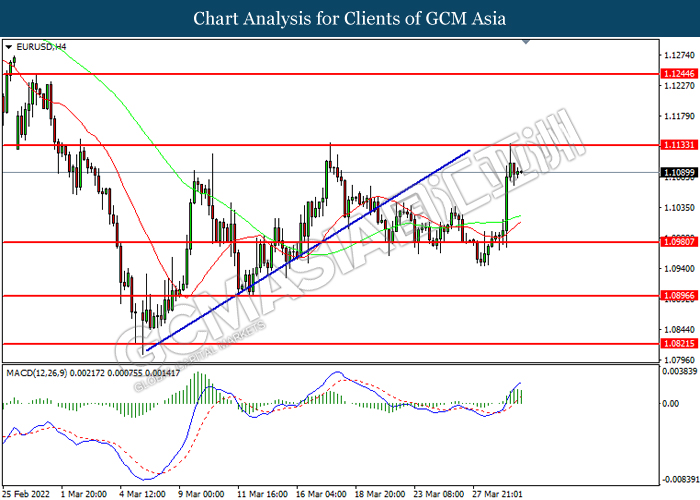

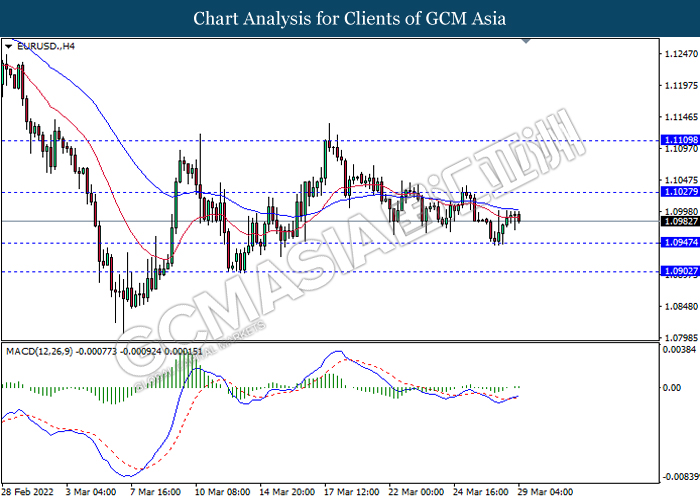

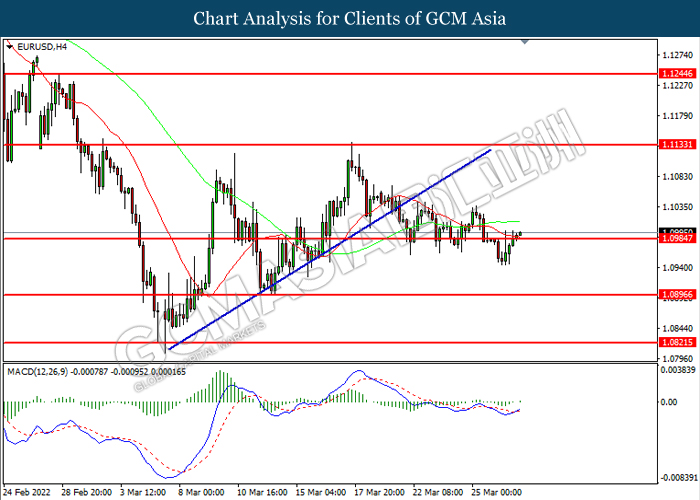

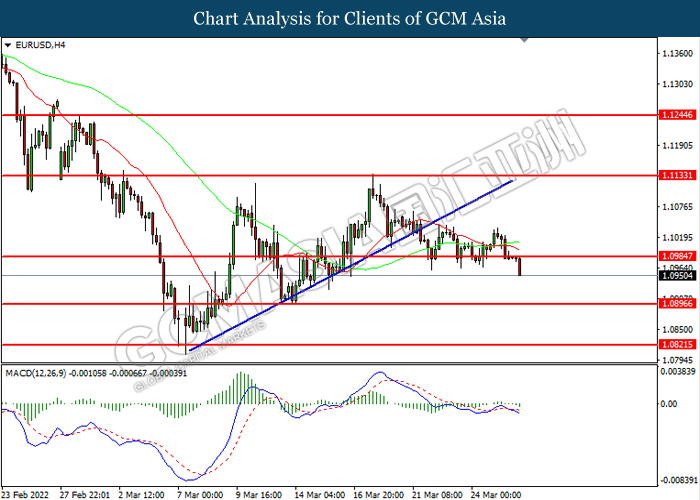

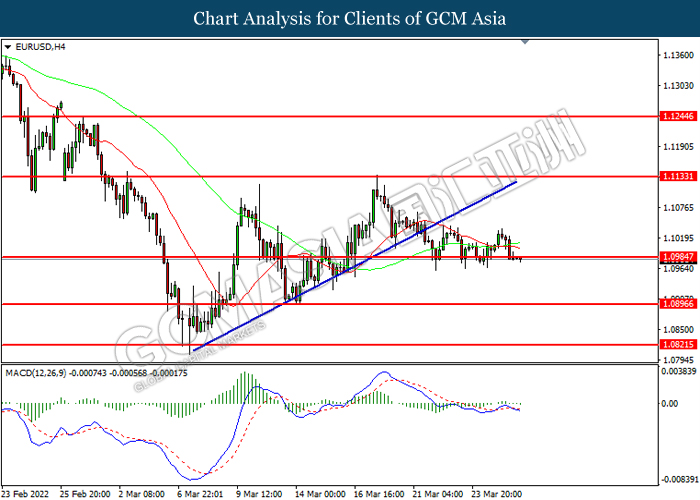

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0970, 1.1135

Support level: 1.0895, 1.0825

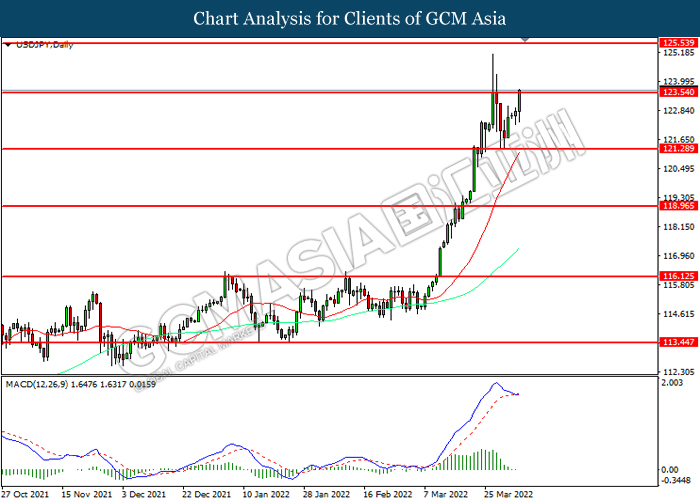

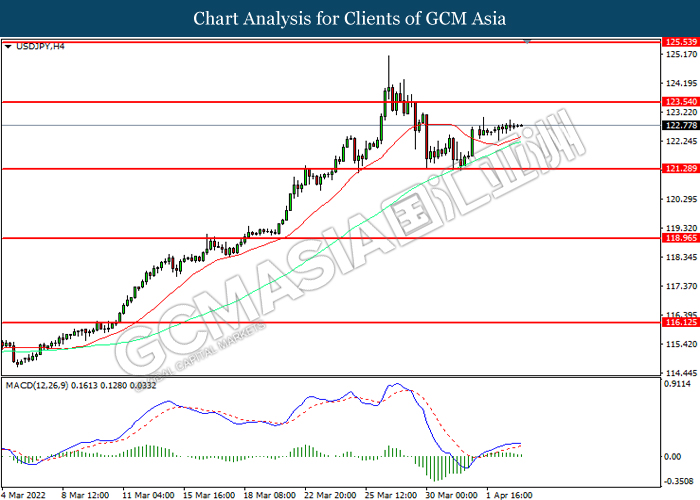

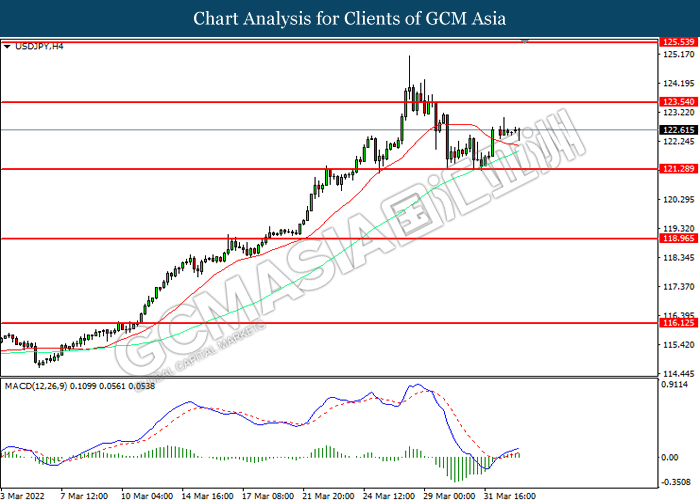

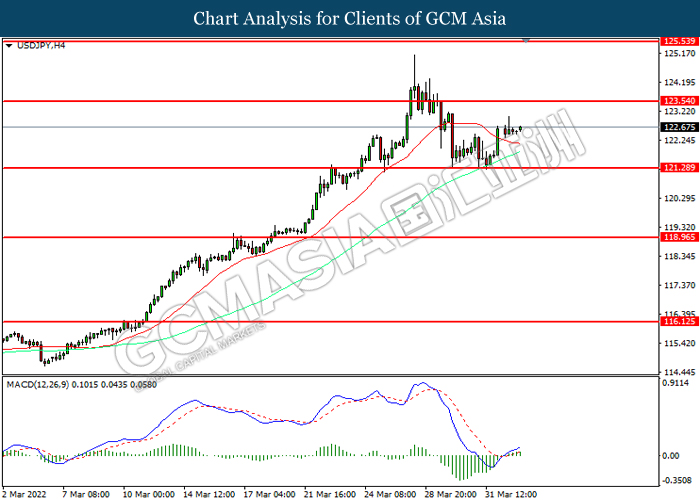

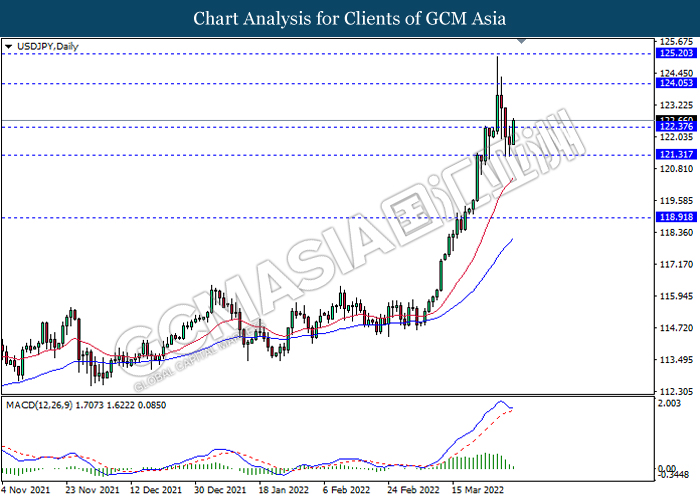

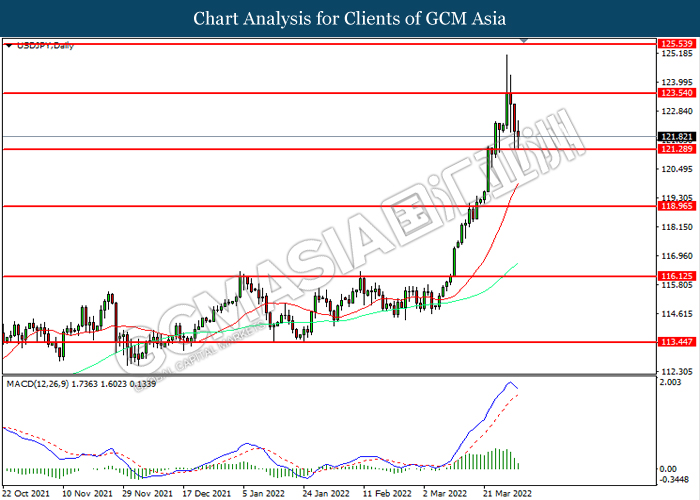

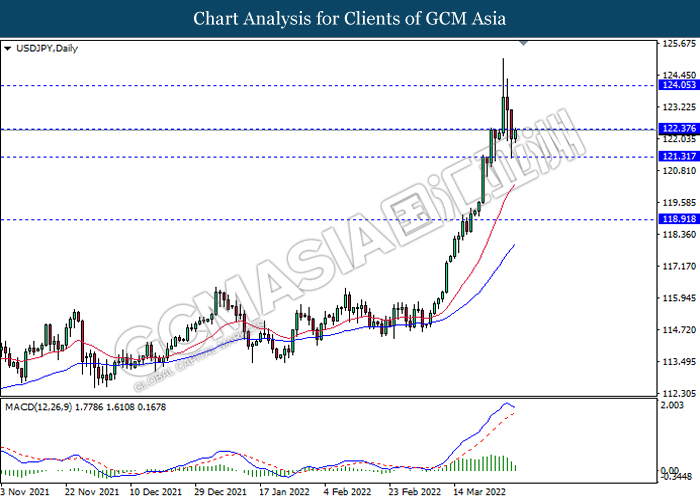

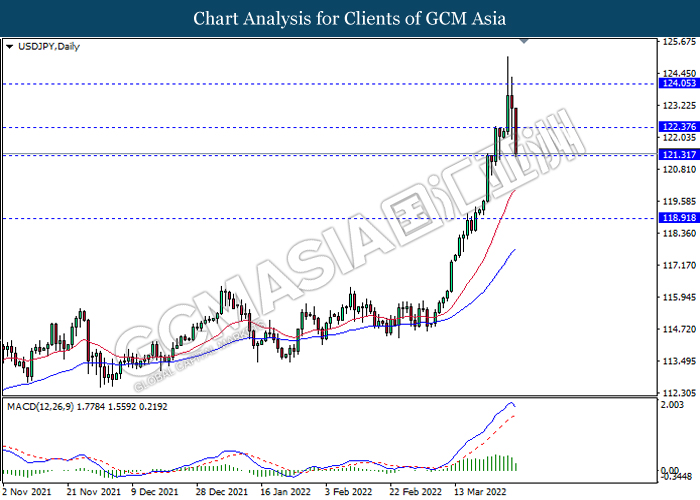

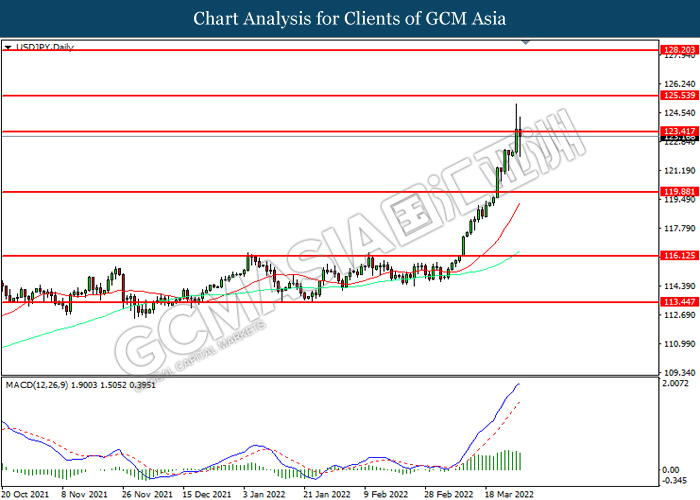

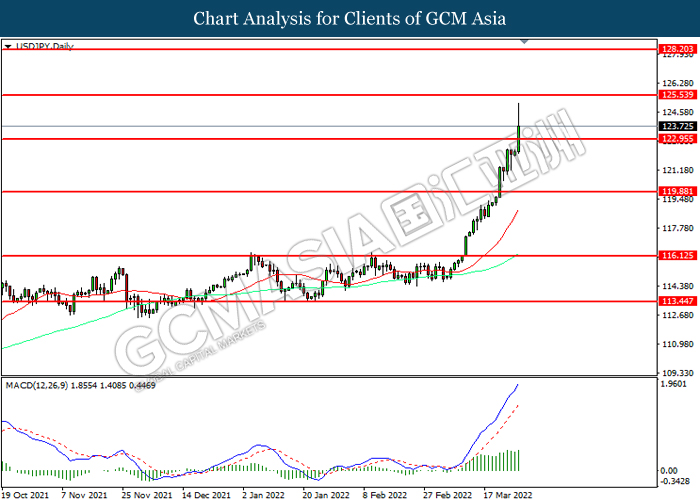

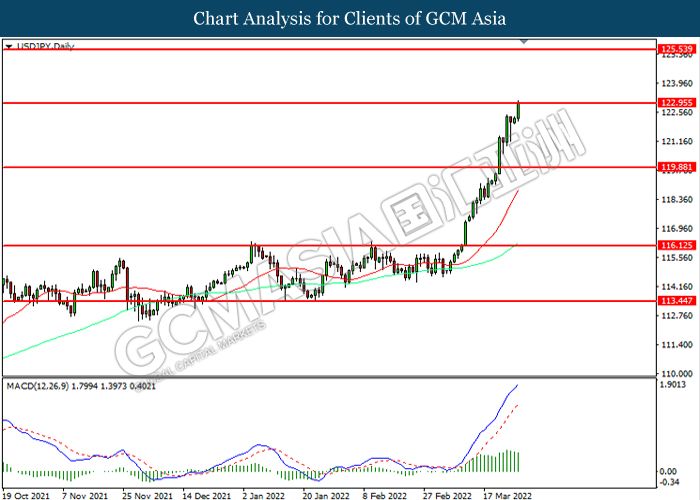

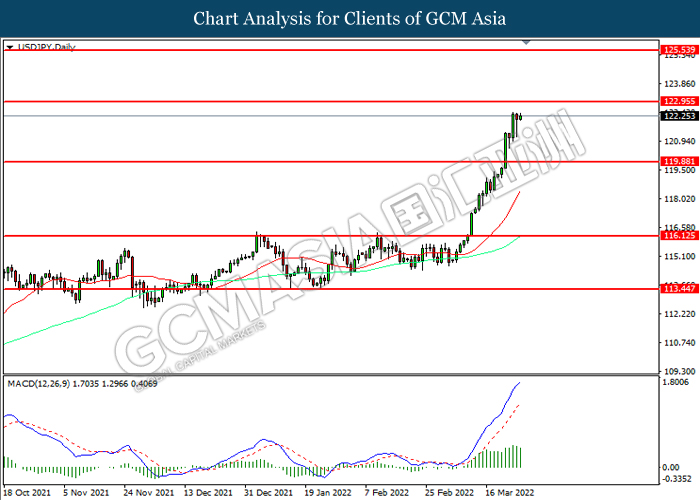

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACFD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

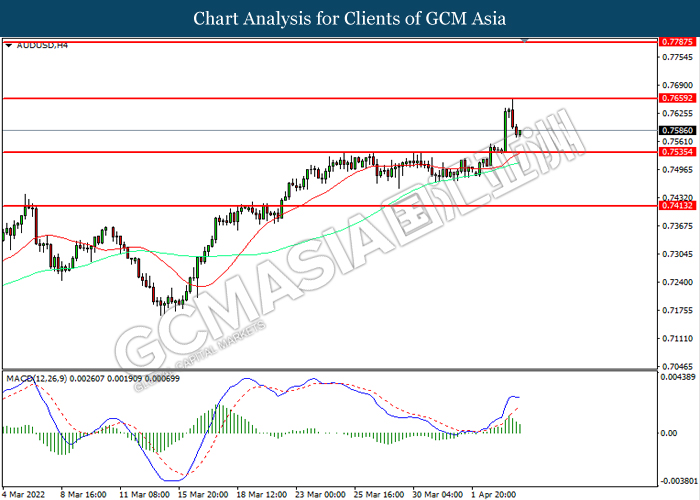

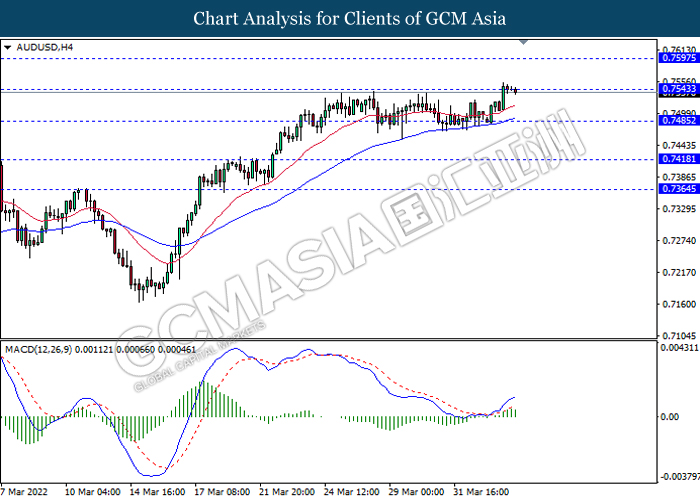

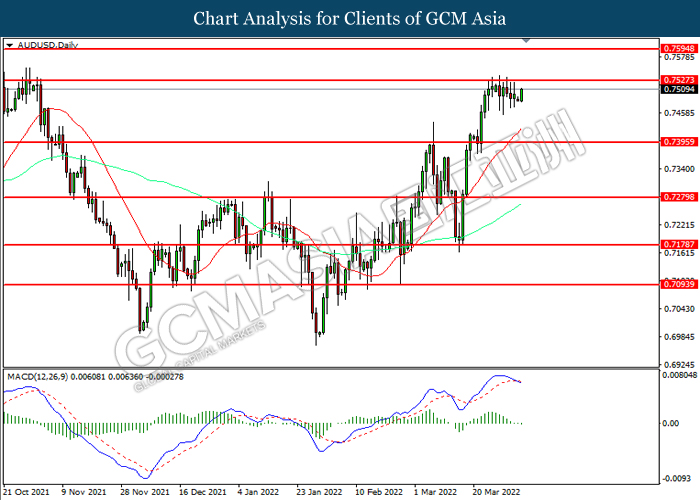

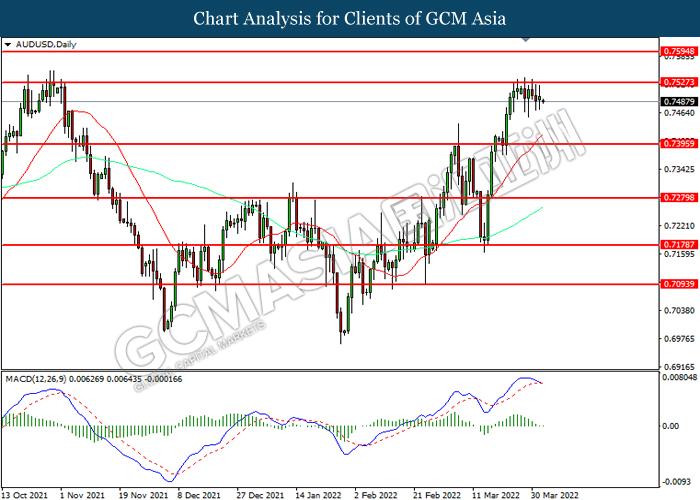

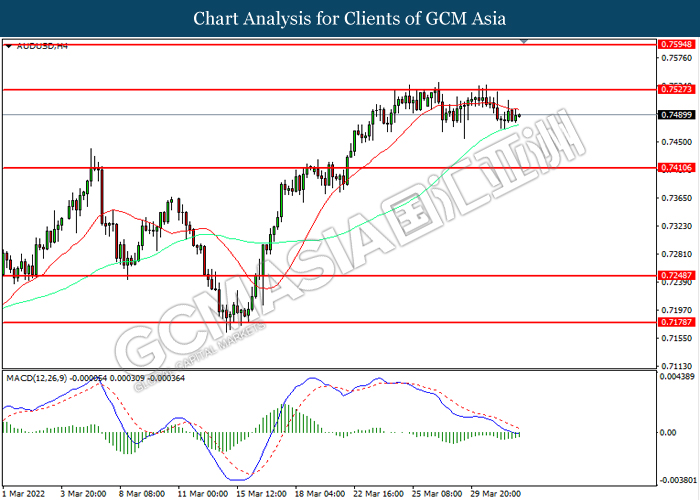

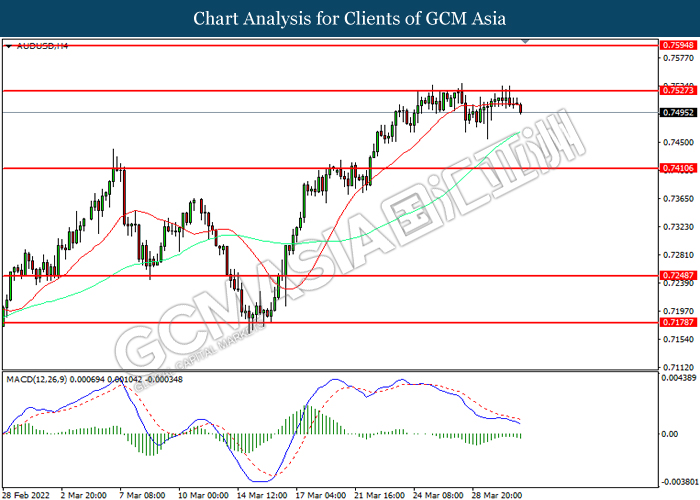

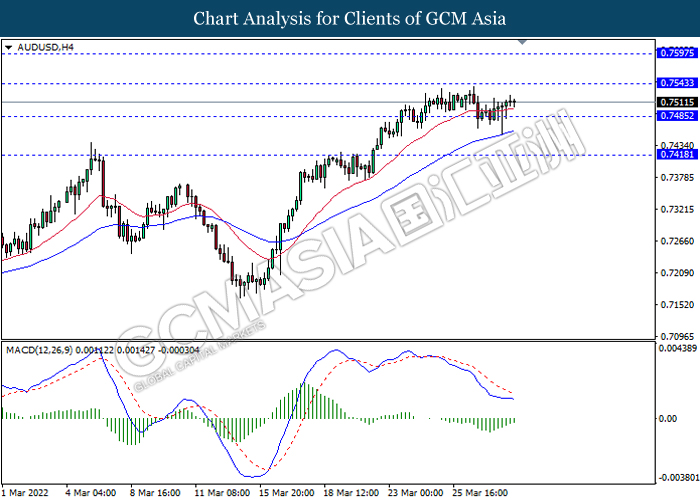

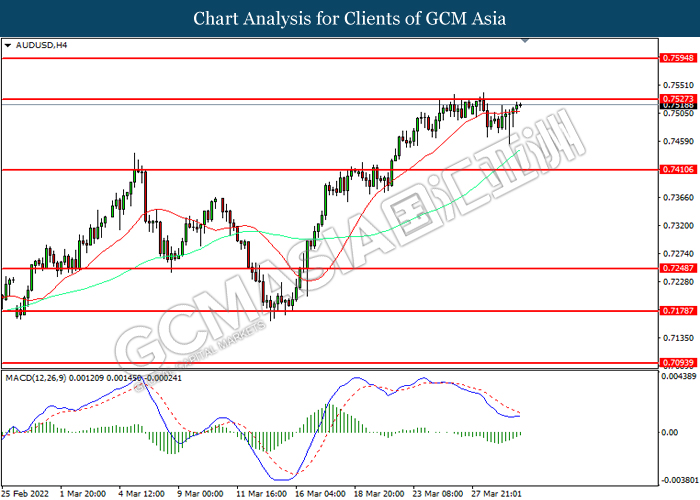

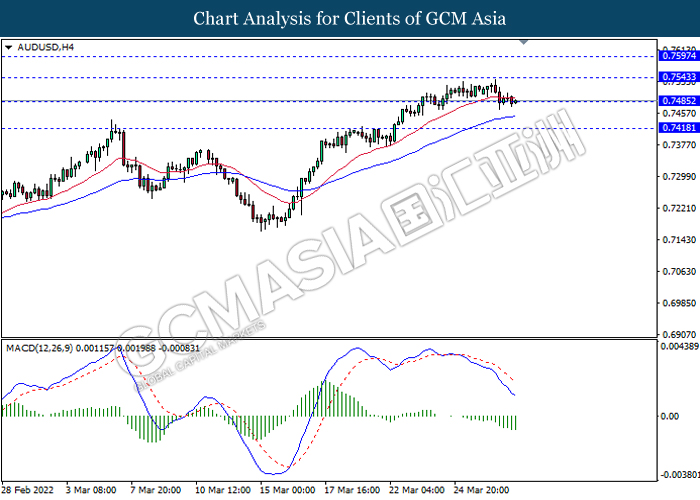

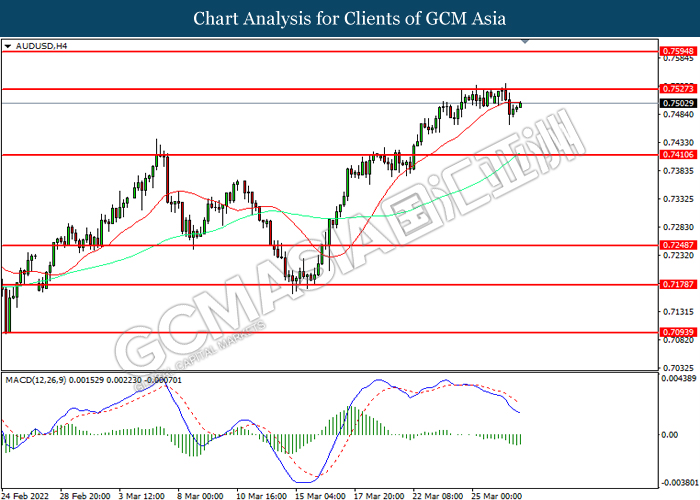

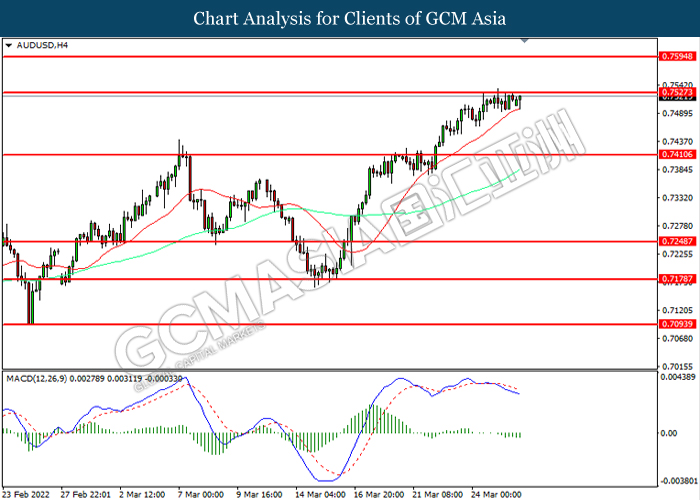

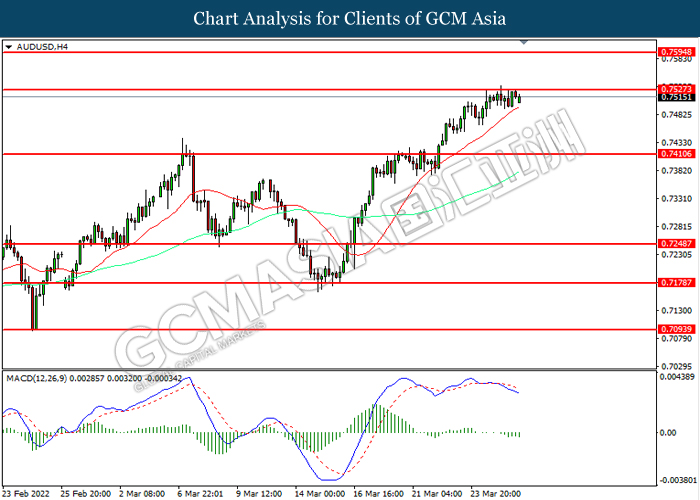

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7660, 0.7785

Support level: 0.7535, 0.7415

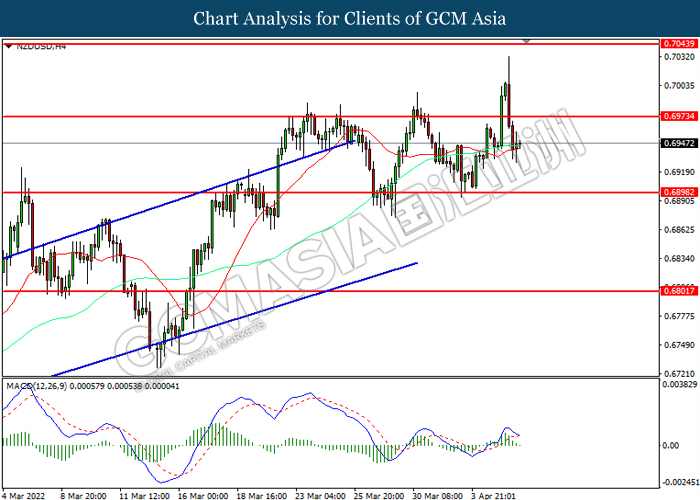

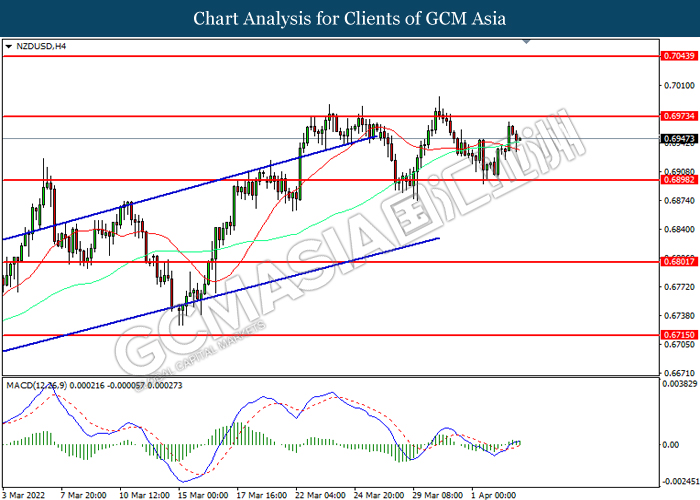

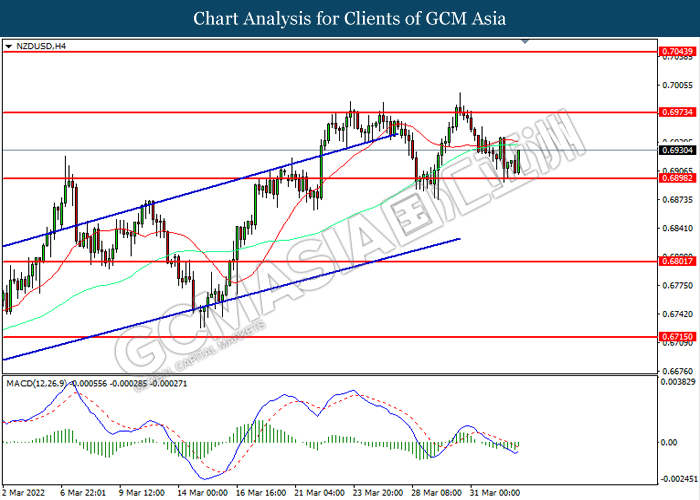

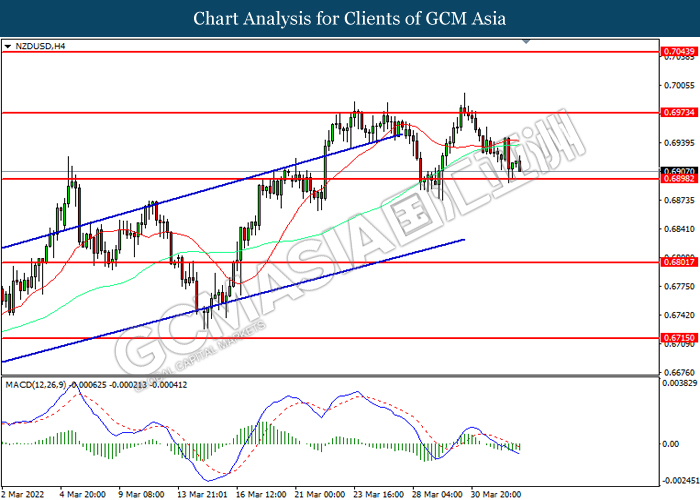

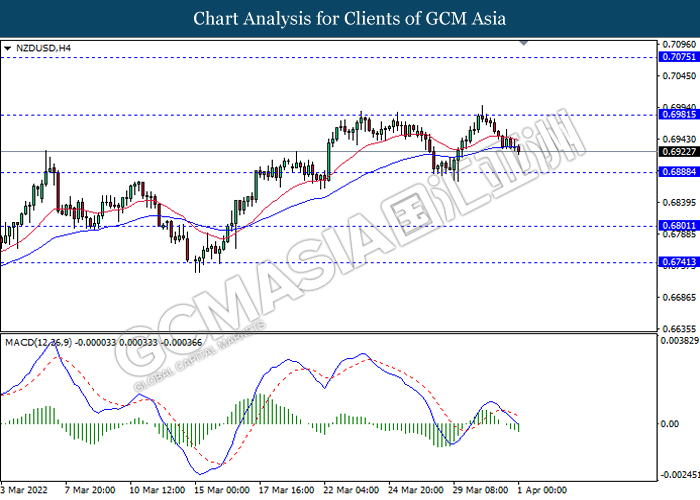

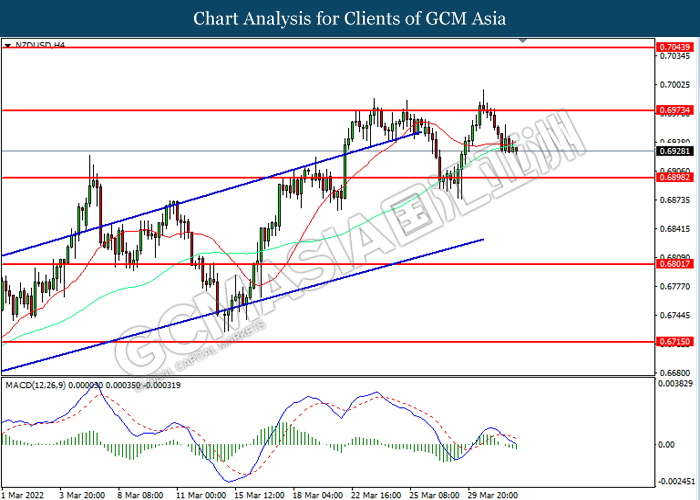

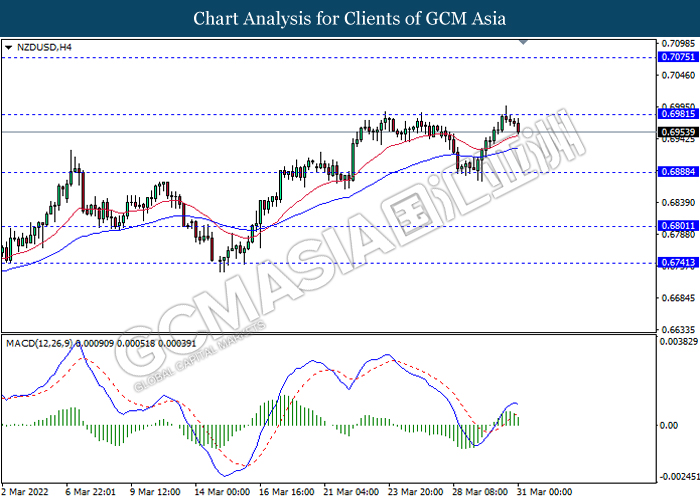

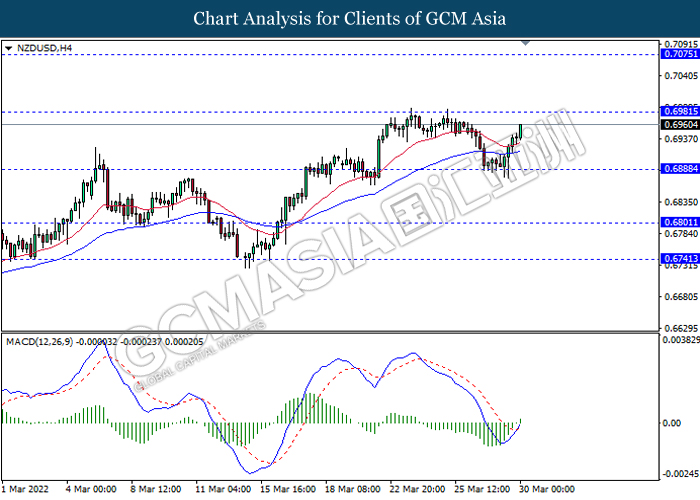

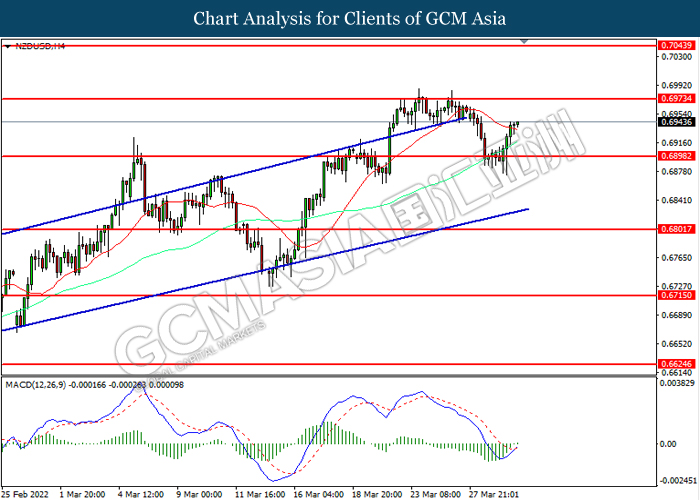

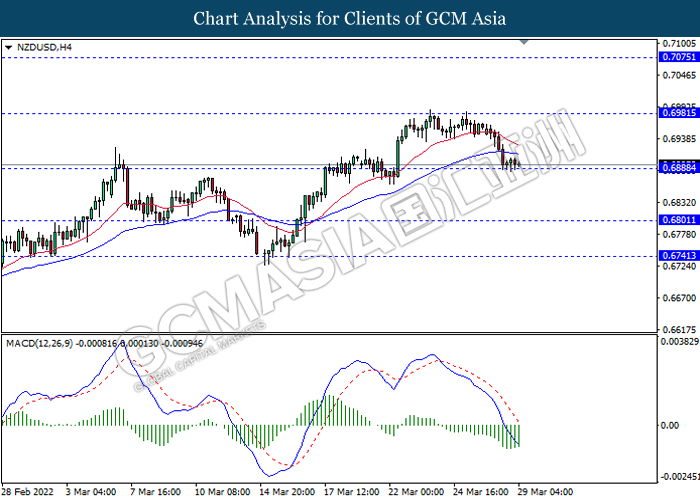

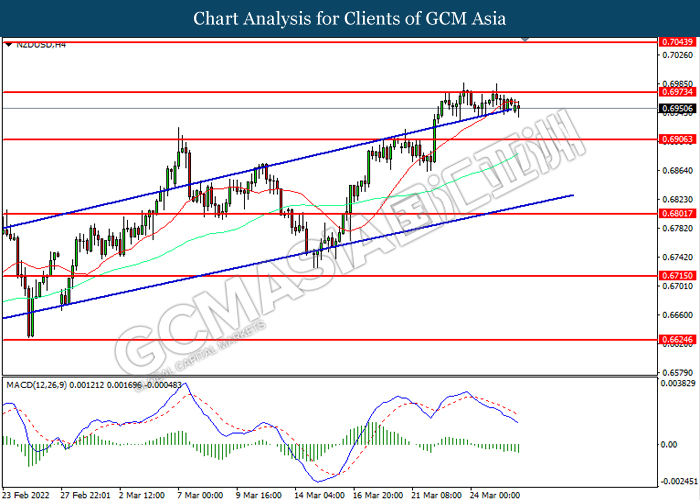

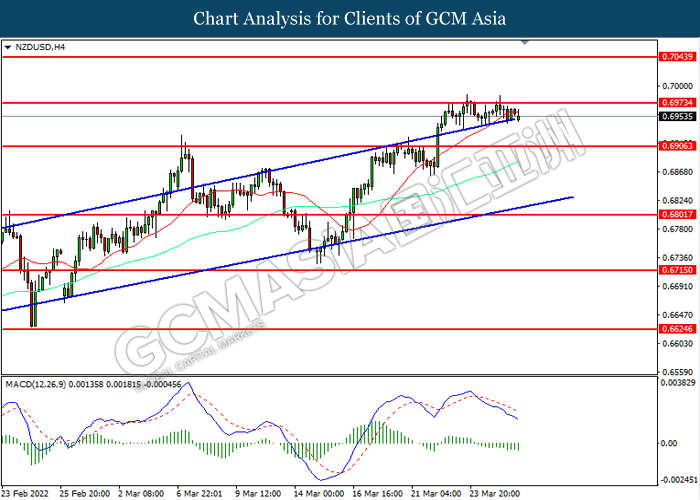

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

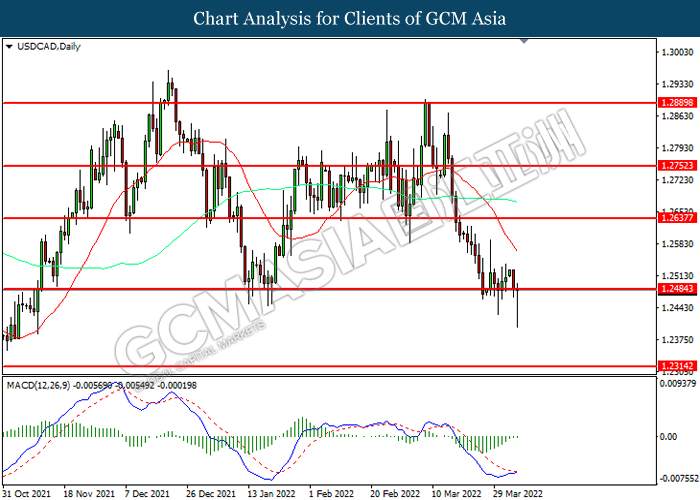

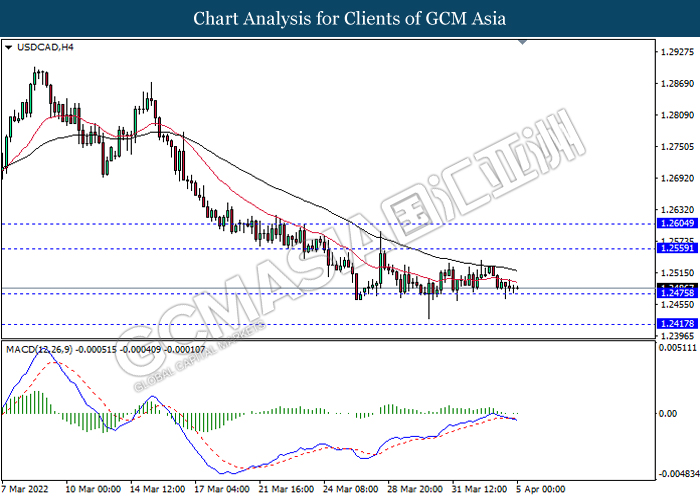

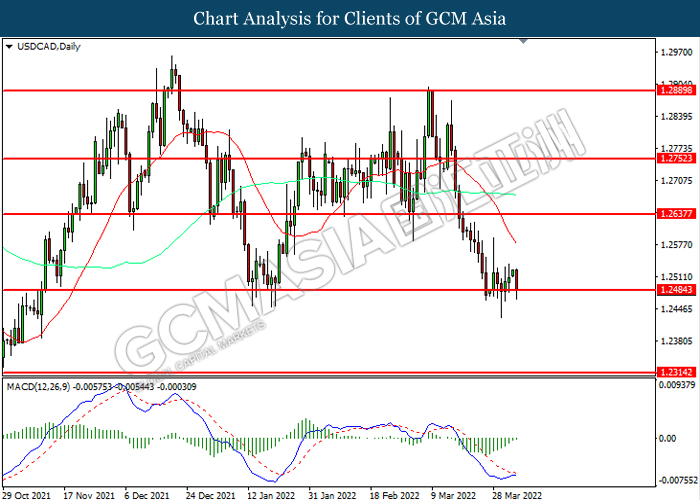

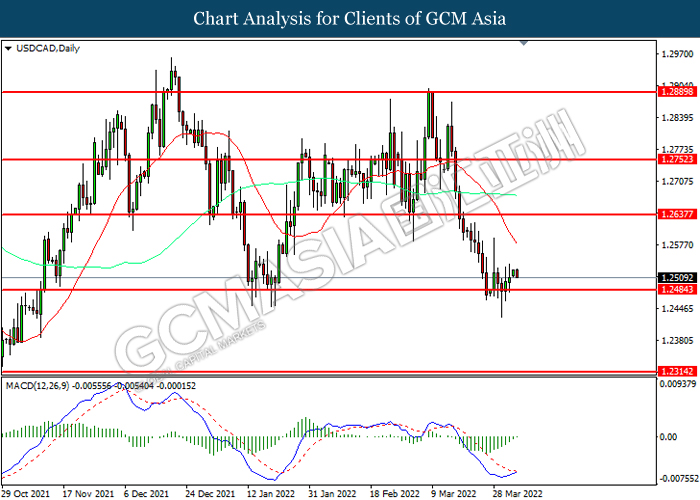

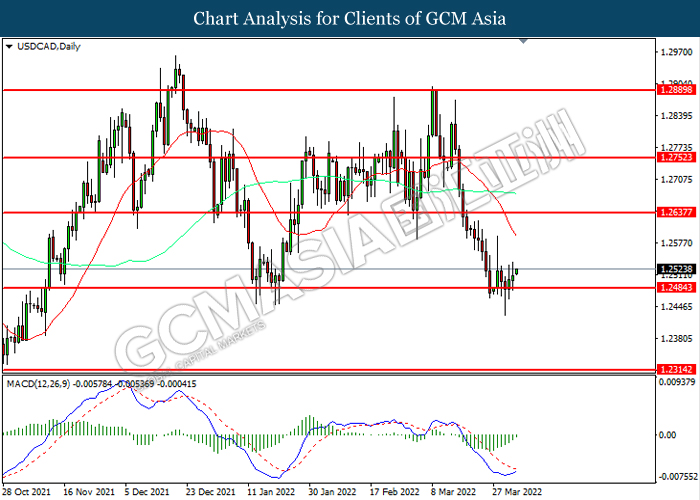

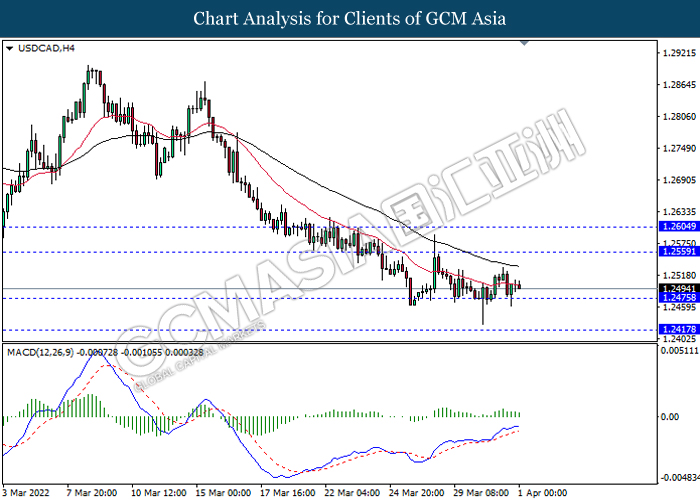

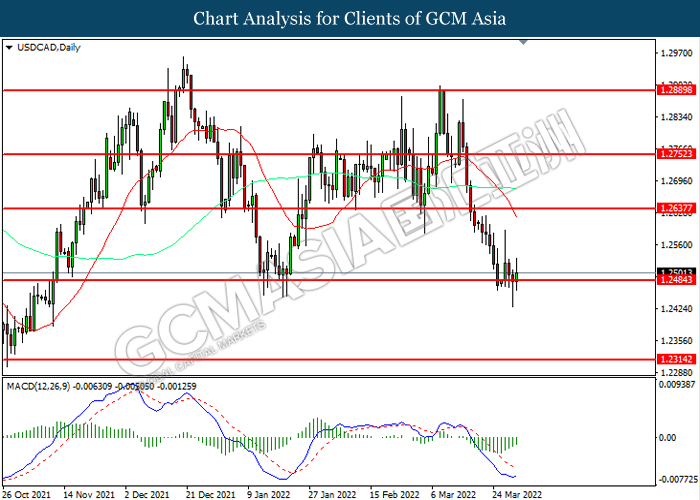

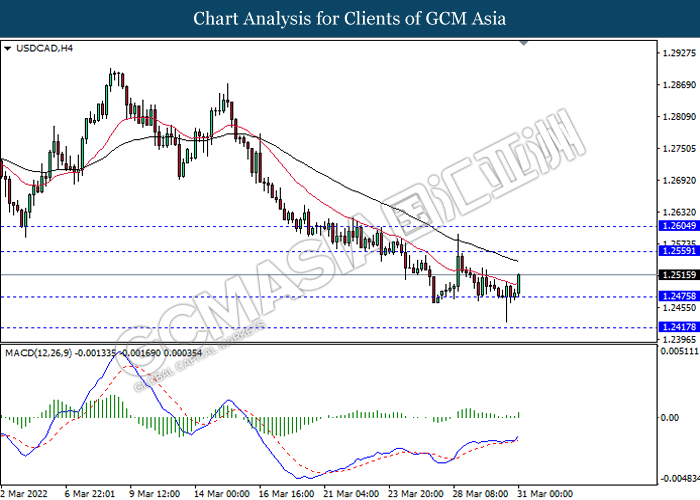

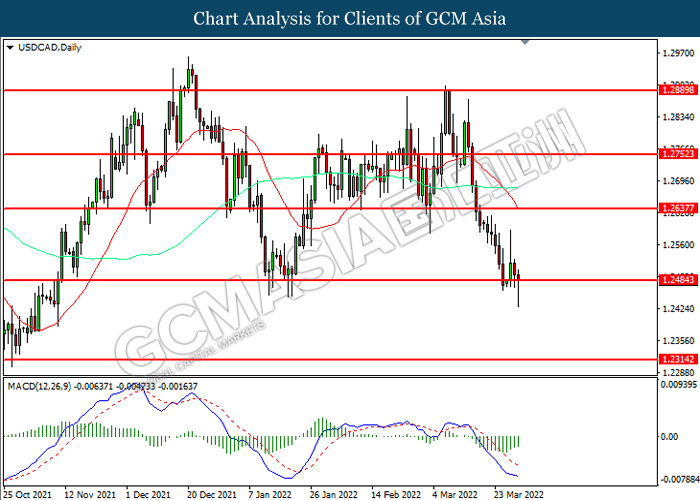

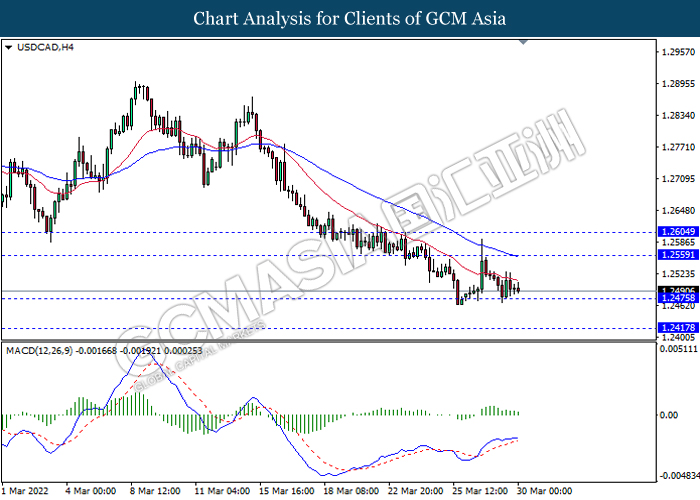

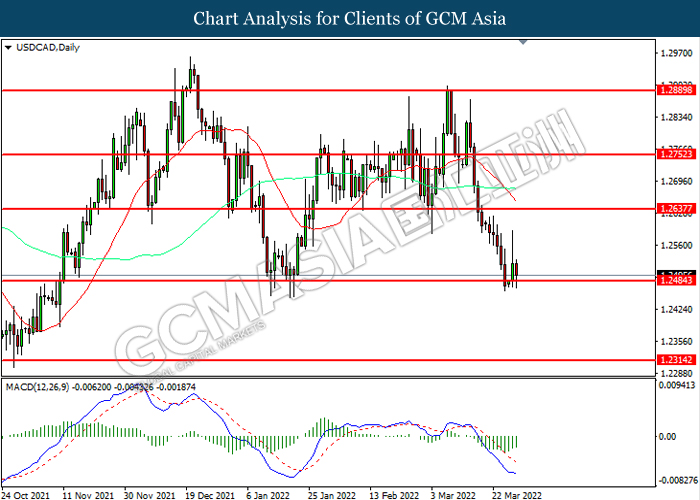

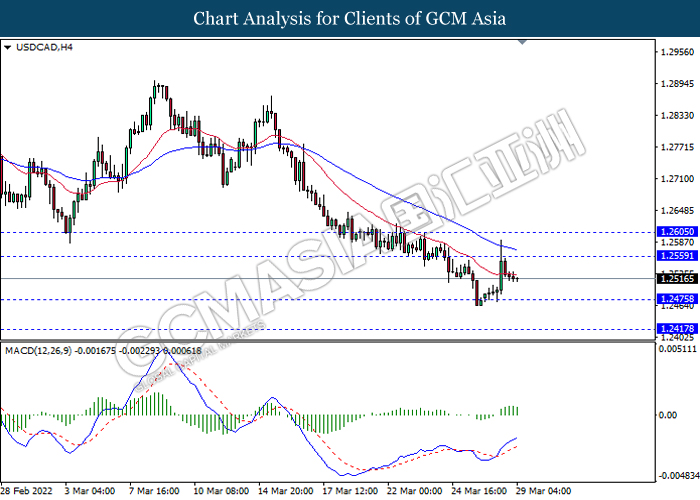

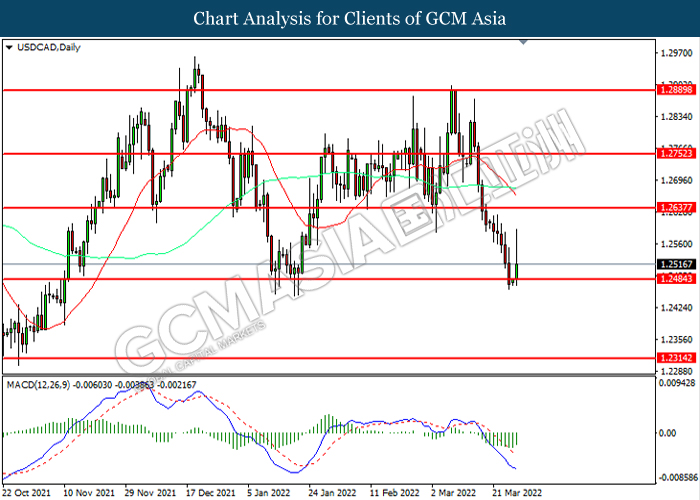

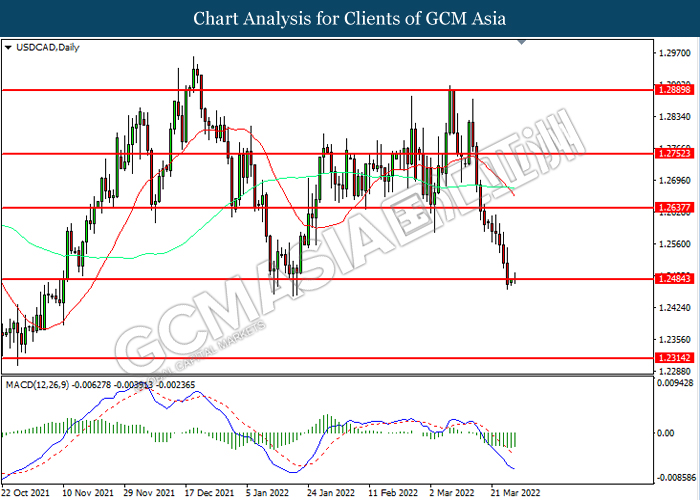

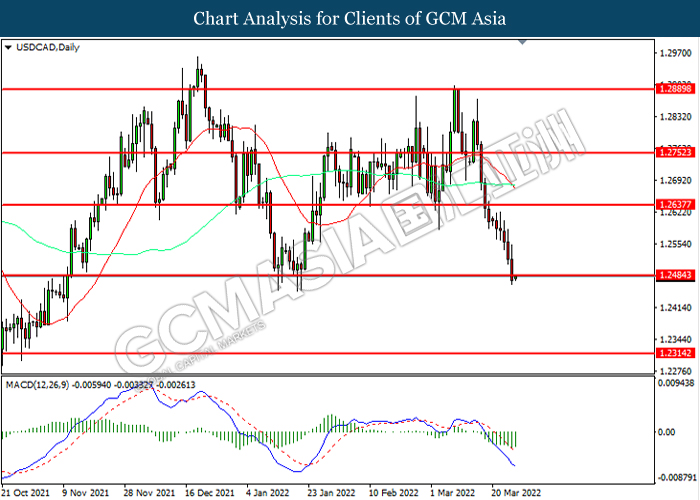

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

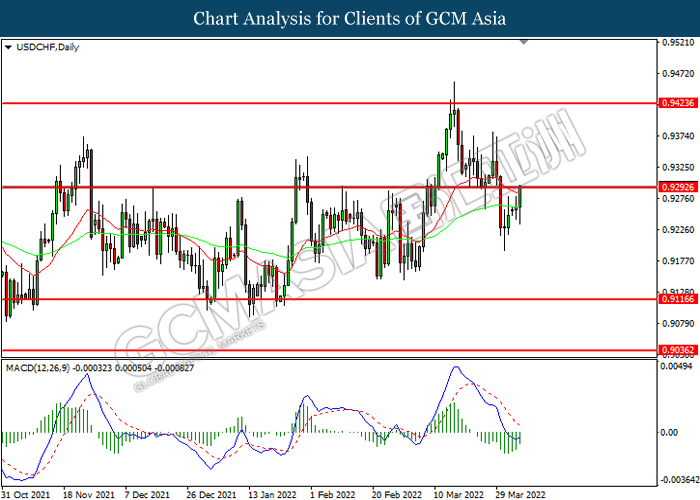

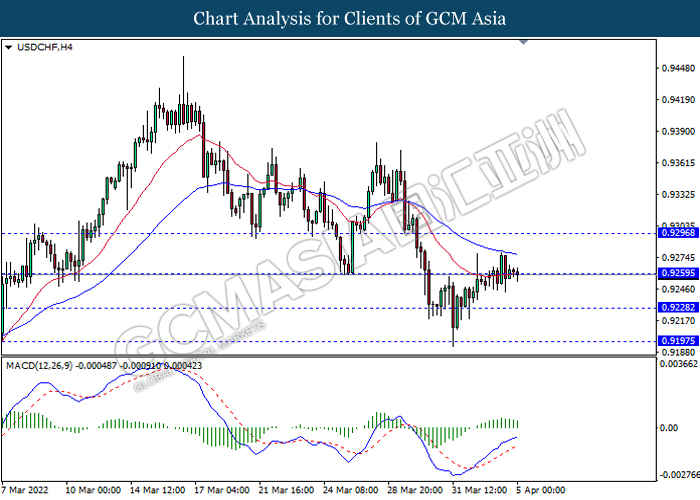

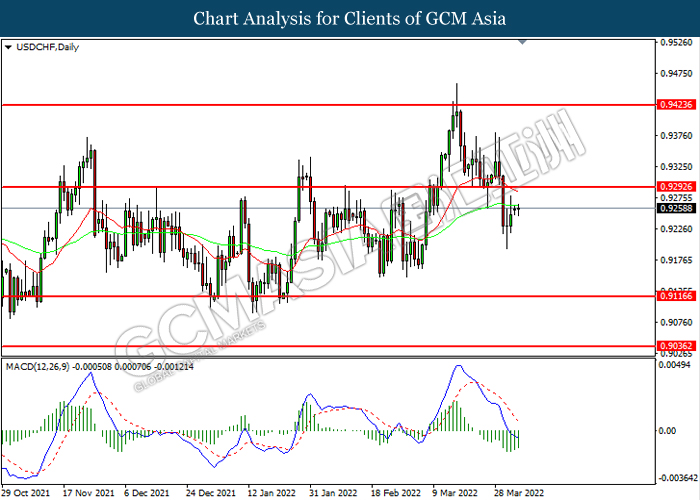

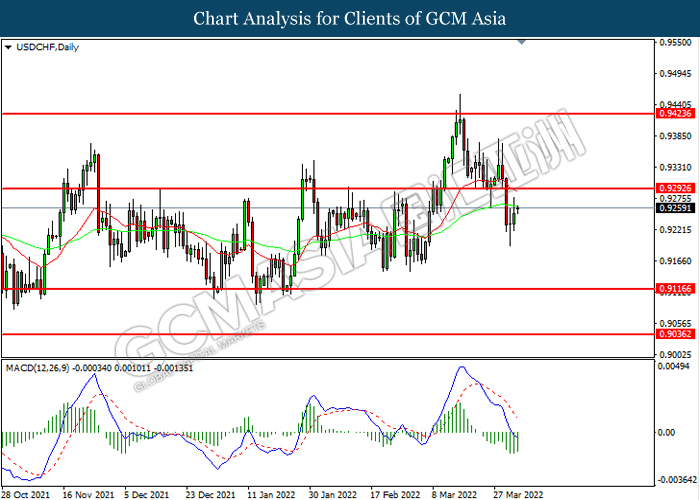

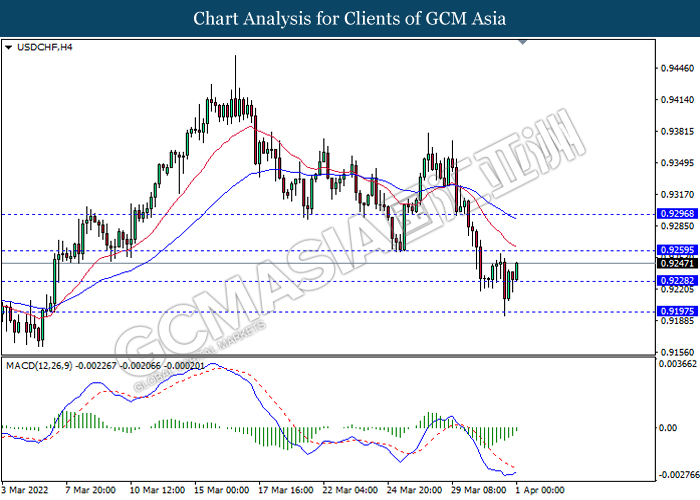

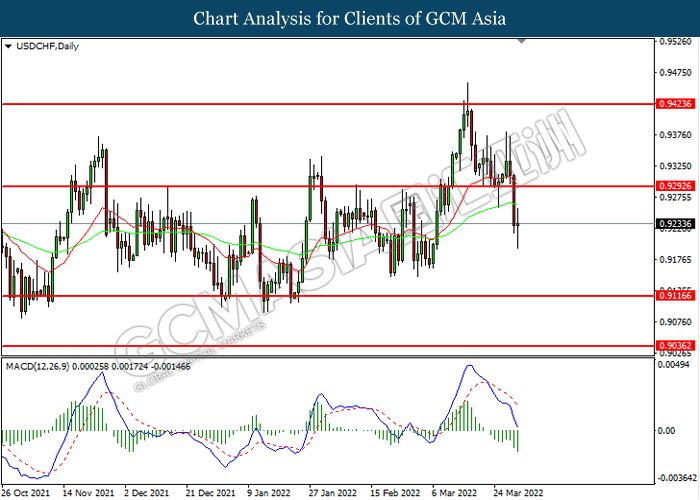

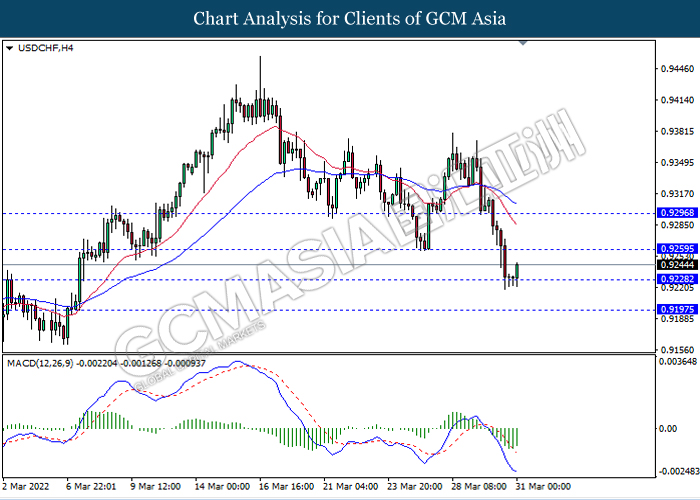

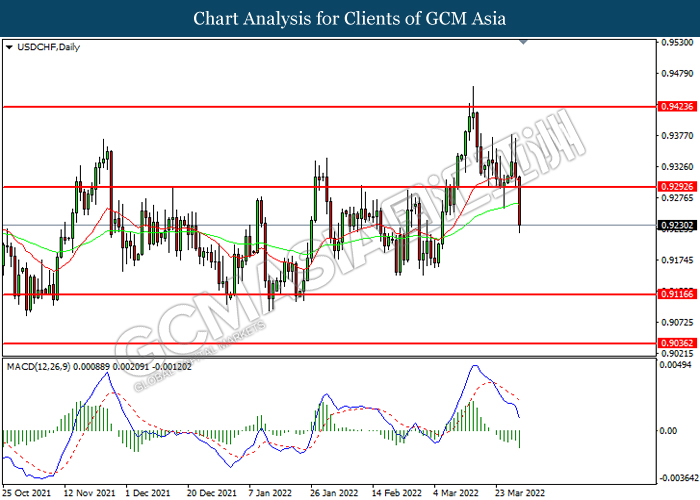

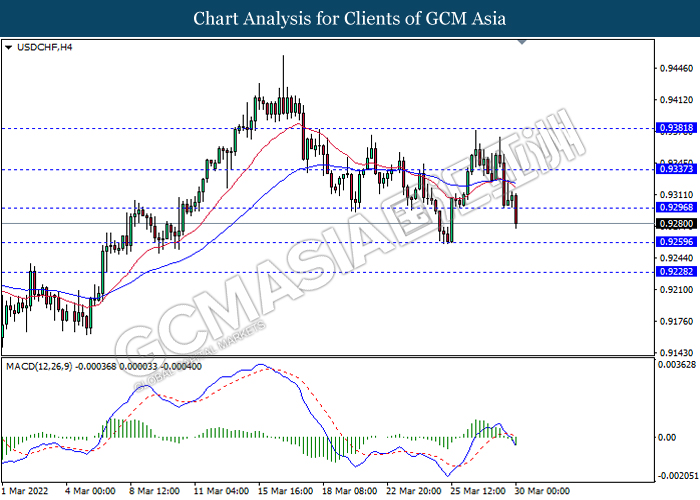

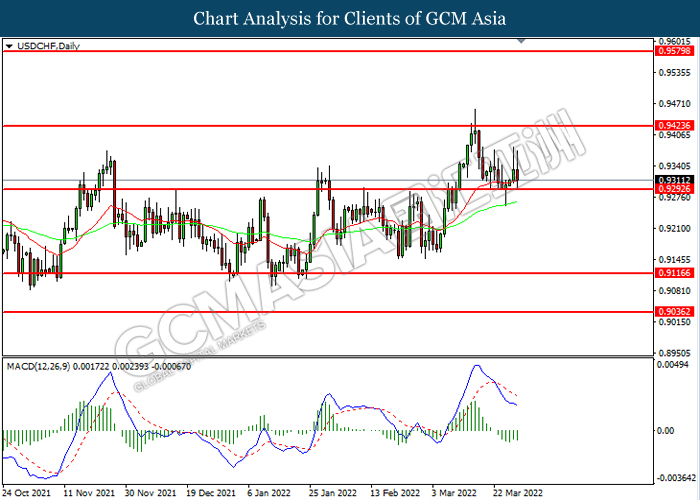

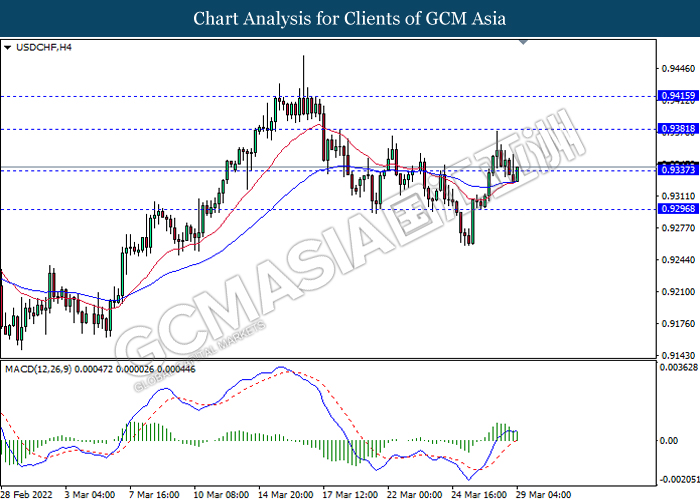

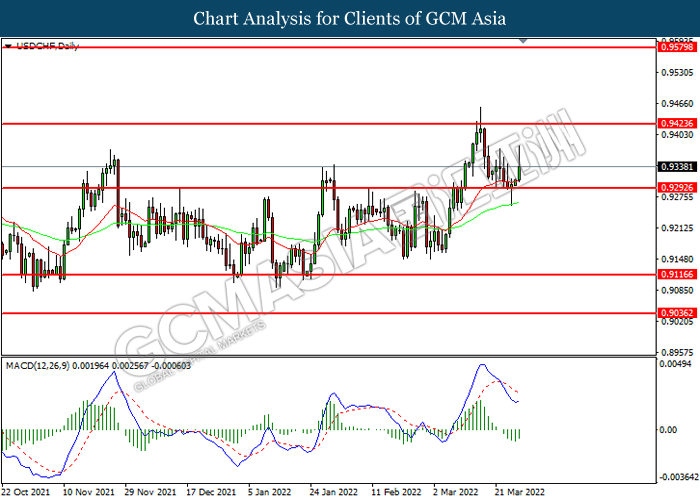

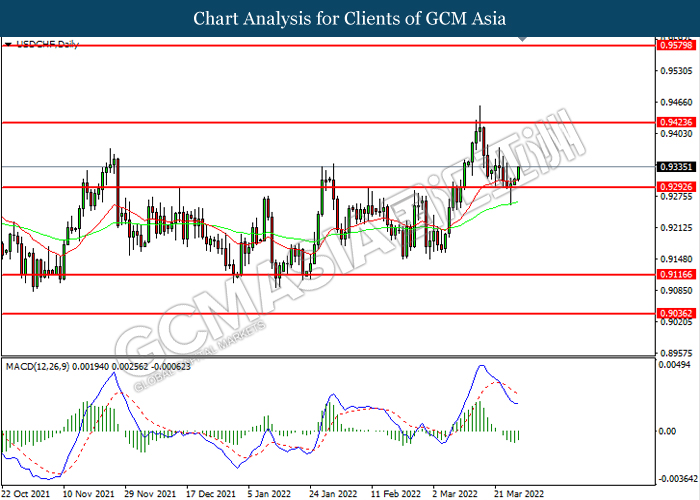

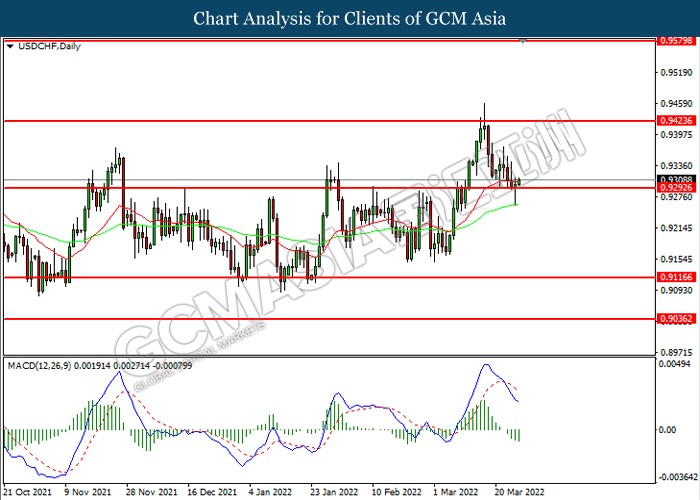

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

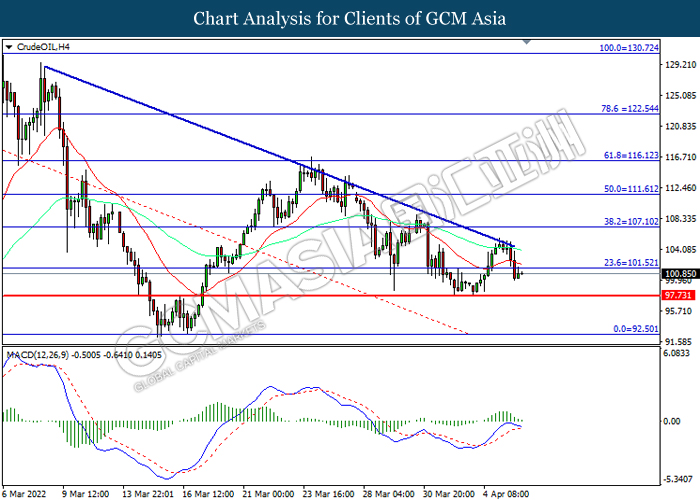

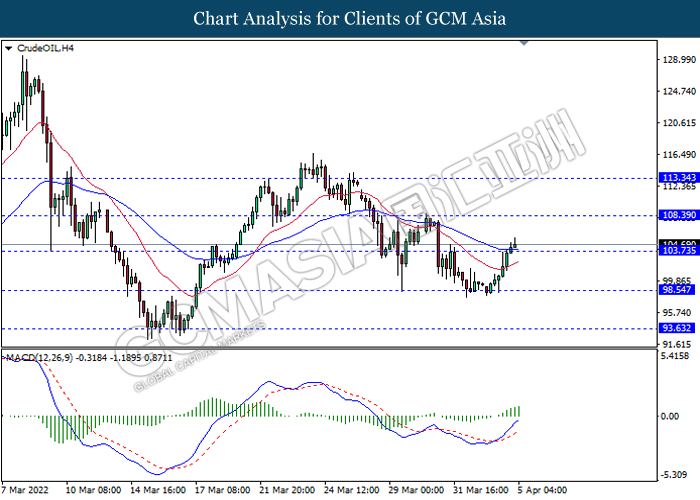

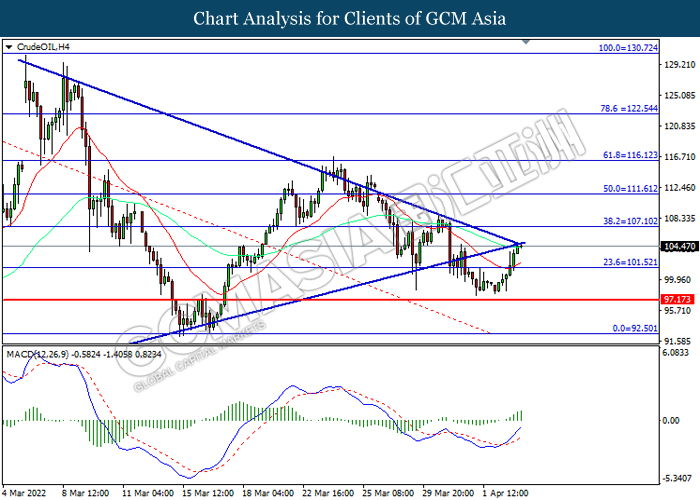

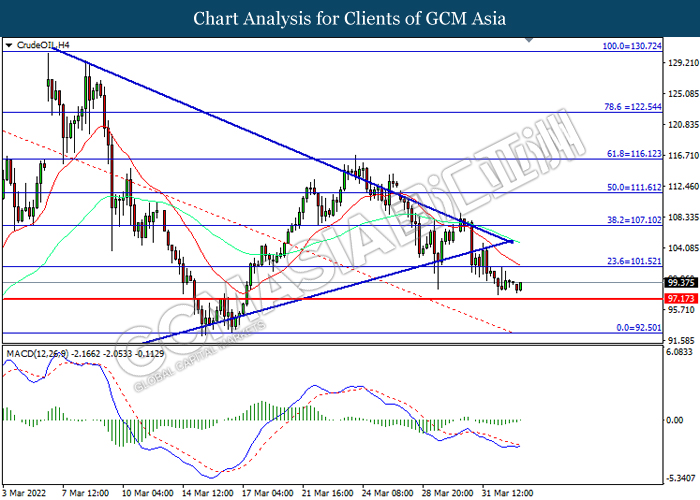

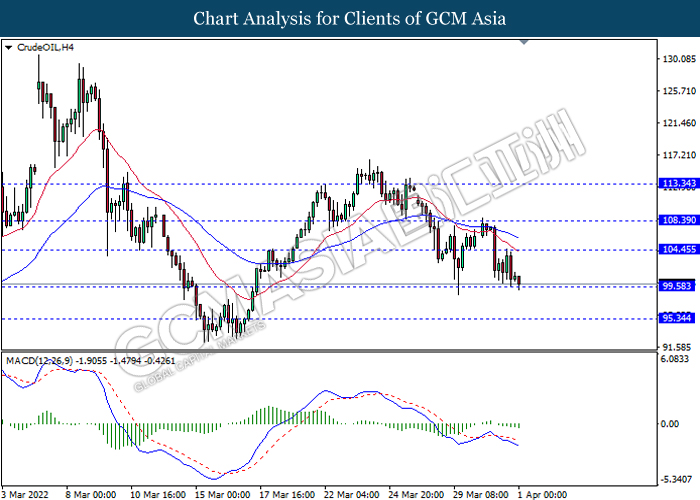

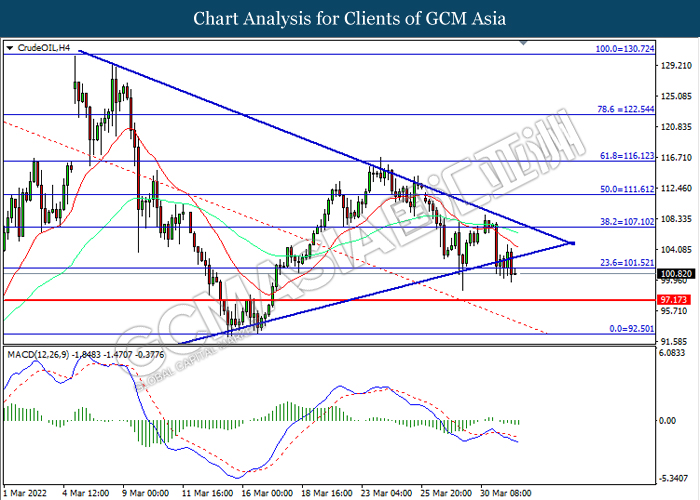

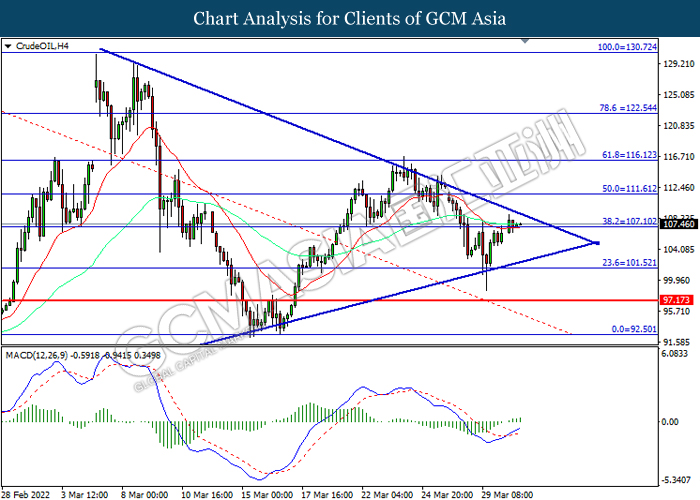

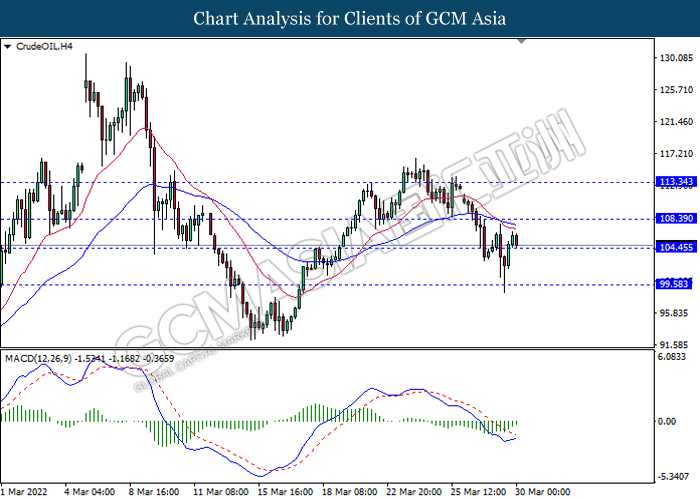

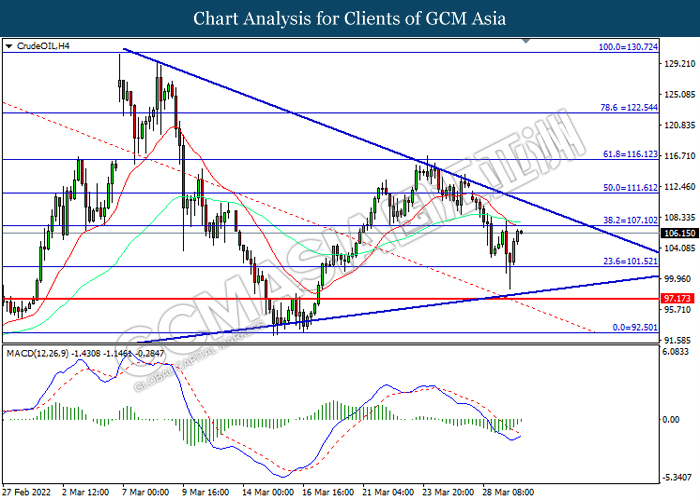

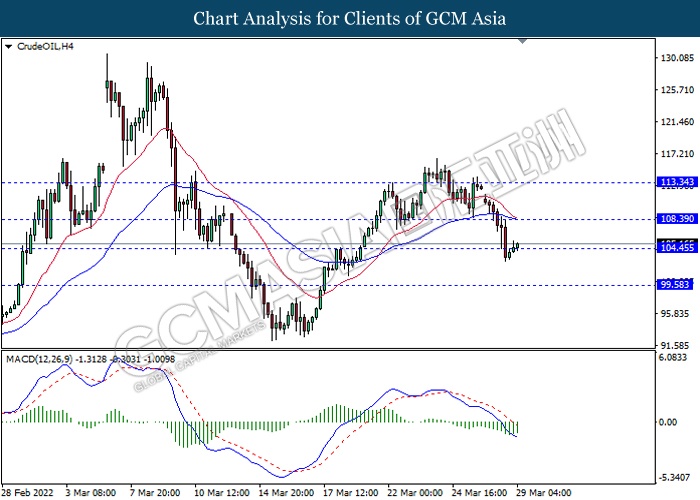

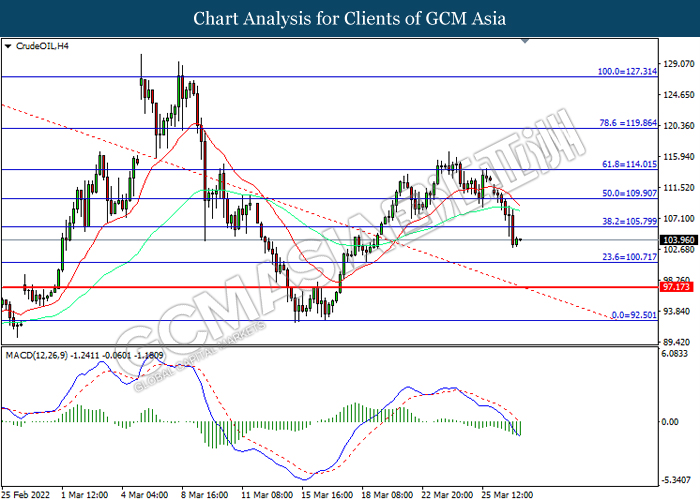

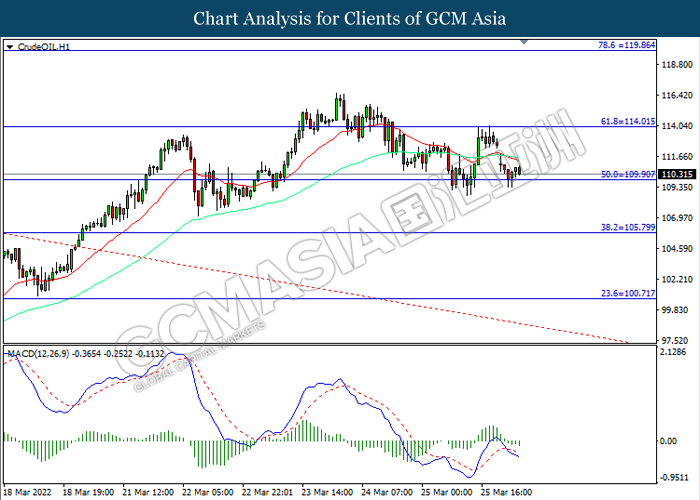

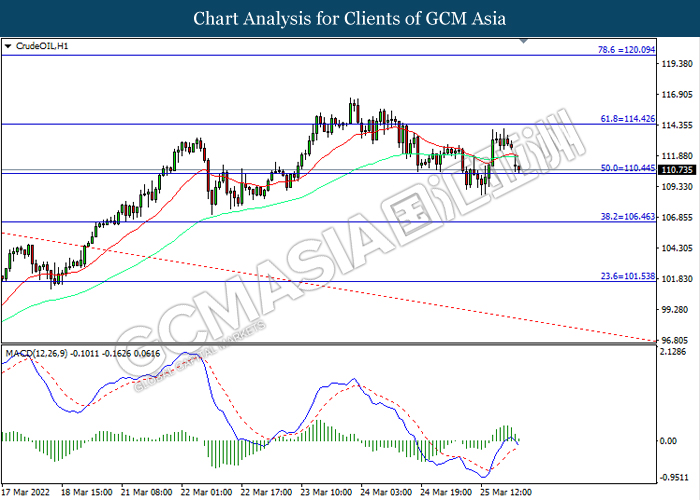

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 101.50, 107.10

Support level: 97.75, 92.50

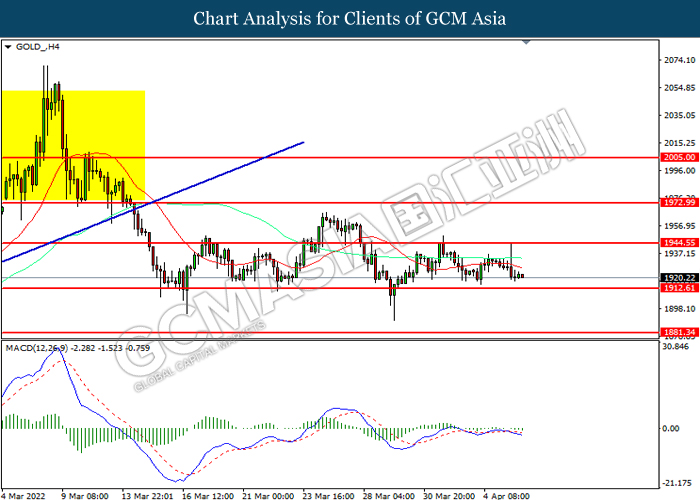

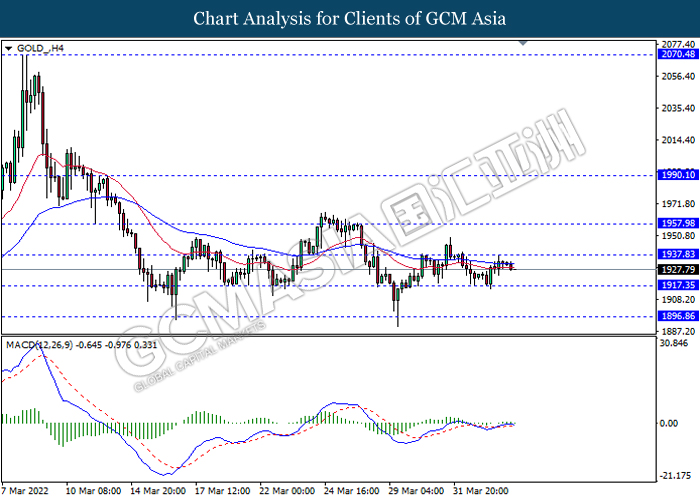

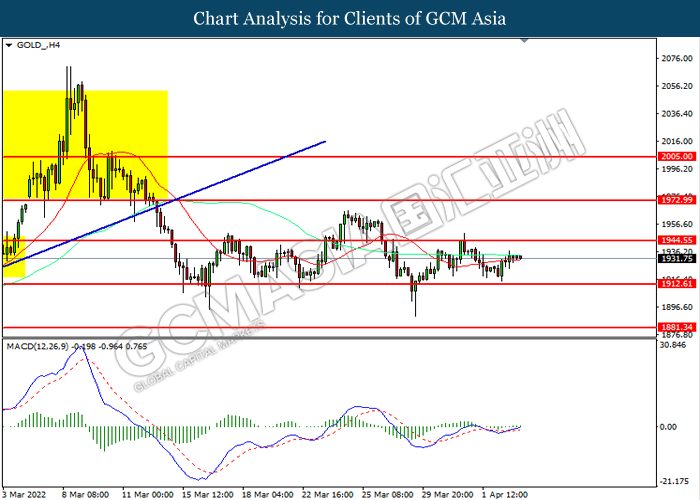

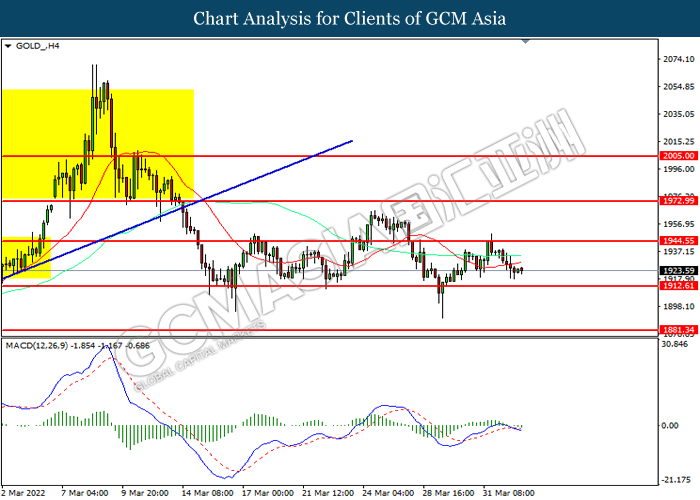

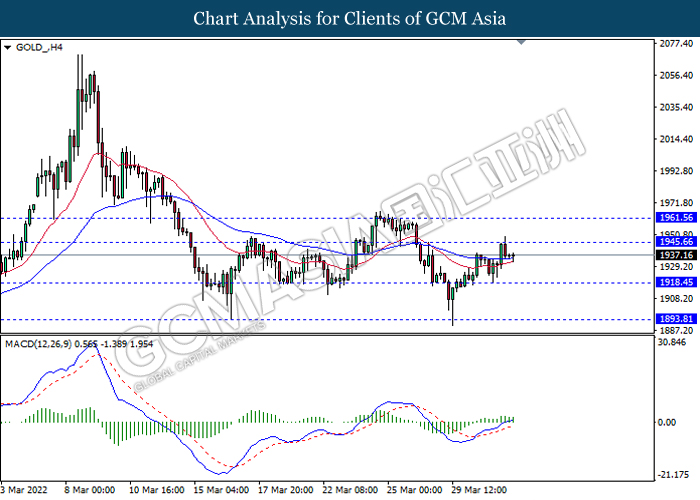

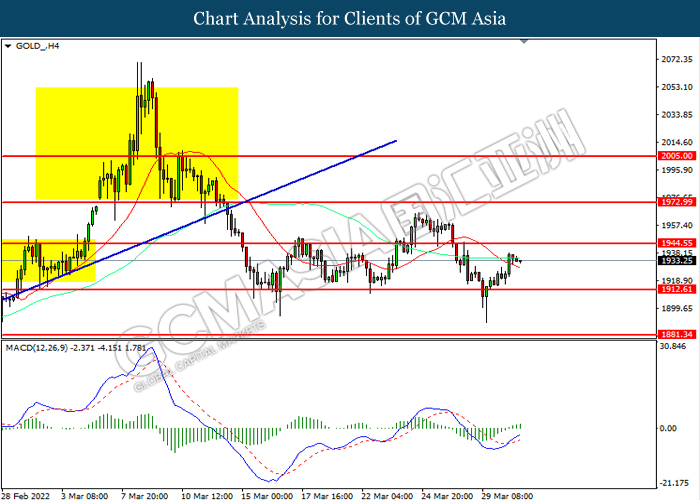

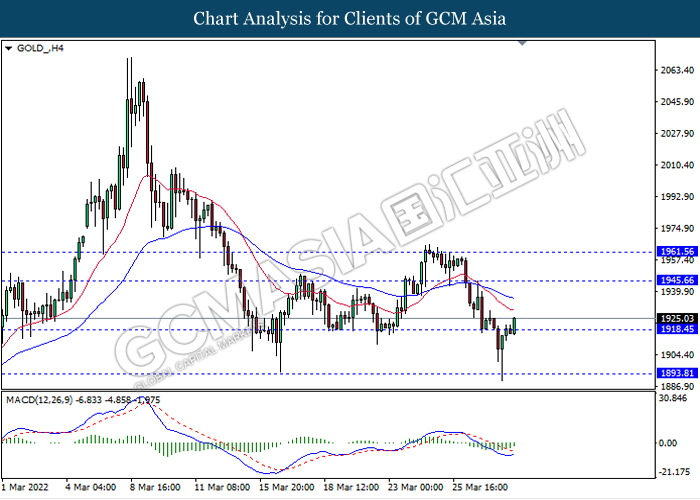

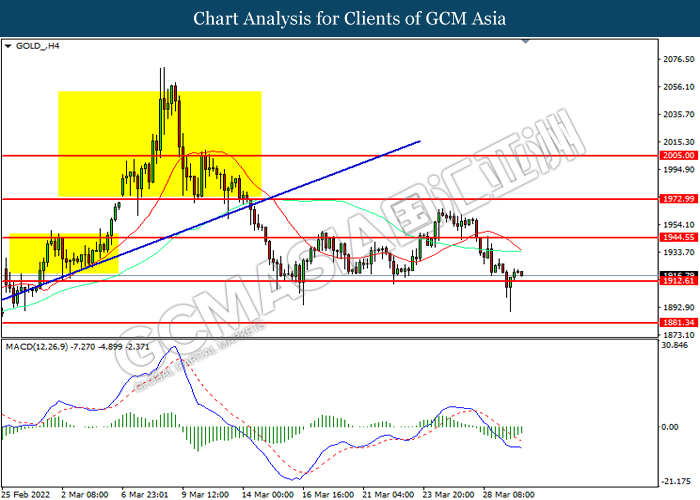

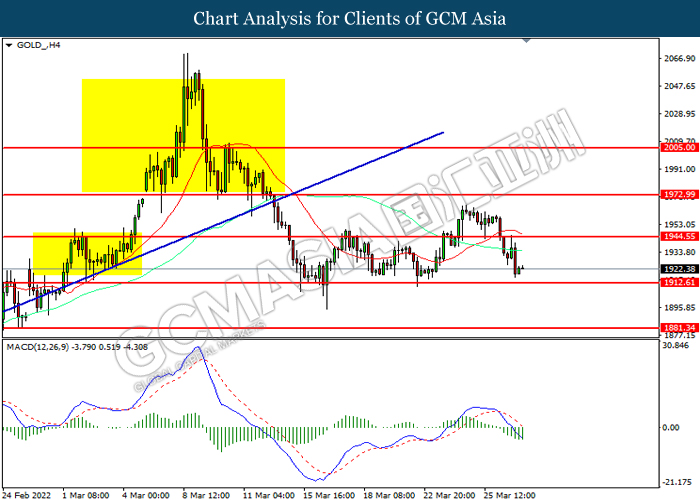

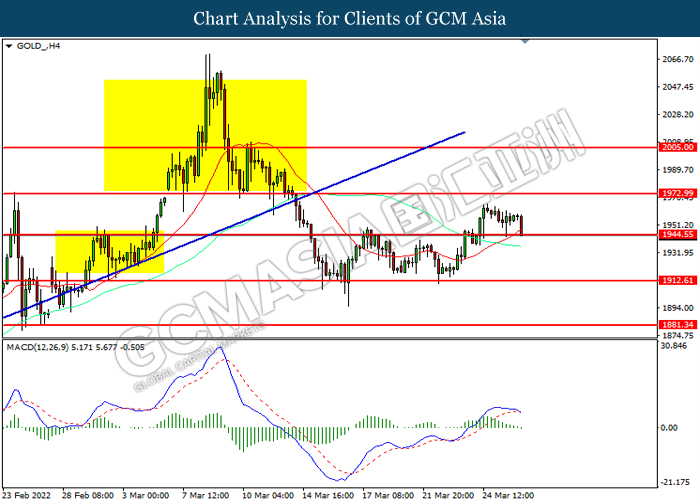

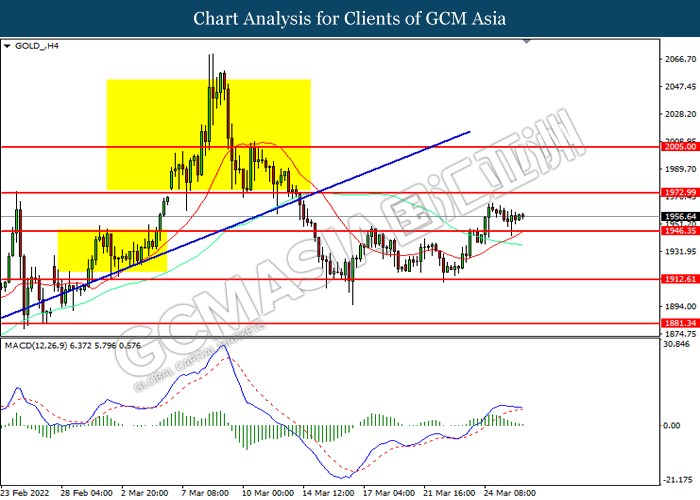

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

050422 Afternoon Session Analysis

5 April 2022 Afternoon Session Analysis

Euro slumped on prospect of more sanctions over Russia-Ukraine issues.

The Euro extends its losses yesterday amid escalation of Russia-Ukraine tensions continue to spur negative prospect toward the economic momentum in European region. According to Reuters, German Defense Minister Christine Lambrecht claimed that the European Union would talk about the implementation of aggressive sanction on Russia, considering to end Russian gas and oil imports from Russia. Market participants concerned that such move would have severe economic ramifications on the Eurozone, as Russia supplies more than 40% of Europe’s gas demand. Besides, French President Macron claimed that he would also support a total ban on Russia oil exports to the EU as soon as this week. The sanction would likely to increase the cost for the raw materials in the European region, affecting the company’s profit margin while sparkling significant inflation risk in future while lowering the purchasing powers of the consumer. As of writing, EUR/USD depreciated by 0.03% to 1.0977.

In the commodities market, the crude oil price extends its gains by 0.92% to 105.75 per barrel as of writing amid the fears upon the supply disruption for the oil persisted in the market. On the other hand, the gold price depreciated by 0.24% to $1928.05 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Apr) | 0.10% | 0.10% | – |

| 12:30 | AUD – RBA Rate Statement | – | – | – |

| 16:30 | GBP – Composite PMI (Mar) | 59.7 | 59.7 | – |

| 16:30 | GBP – Services PMI (Mar) | 61 | 61 | – |

| 18:00 | USD – ISM Non-Manufacturing PMI (Mar) | 56.5 | 58 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1025, 1.1110

Support level: 1.0955, 1.0890

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7545, 0.7595

Support level: 0.7485, 0.7420

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9260, 0.9295

Support level: 0.9230, 0.9195

CrudeOIL, H4: Crude oil price was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 108.40, 113.35

Support level: 103.75, 98.55

GOLD_, H4: Gold price was traded lower following prior retracement from resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1937.85, 1958.00

Support level: 1917.35, 1896.85

050422 Morning Session Analysis

5 April 2022 Morning Session Analysis

US Dollar surged amid rising tensions between Russia-Ukraine.

The Dollar Index which traded against a basket of six major currencies surged over the backdrop of risk-off sentiment in the global financial market following the Europe leaders called for more sanction against Russia after war crimes allegations in Ukraine. Germany and its international partner will agree further sanctions on Russia in the coming days, a government spokesperson said on Monday, adding that he was confident that European Union would remain united on fresh measures. Besides that, the Dollar Index extend its gains as market participants continue to digest a strong economy recovery and tight labor market in United States. Currently, market participants speculated that there would be a very strong chance of 50 basis point rate hike by next month. 2-year Treasury yields continue to climb into recent high at 2.5%. As of writing, the Dollar Index appreciated by 0.31% to 98.95.

In the commodities market, the crude oil price surged 3.82% to $103.05 per barrel as of writing amid the fresh implementation of sanctions toward Russia oil and gas industry continue to spur bullish momentum on this black commodity. On the other hand, the gold price surged 0.30% to $1931.40 per troy ounces as of writing amid diminishing risk appetite in the global financial market as the fresh sanction expectation from the Western countries.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Apr) | 0.10% | 0.10% | – |

| 12:30 | AUD – RBA Rate Statement | – | – | – |

| 16:30 | GBP – Composite PMI (Mar) | 59.7 | 59.7 | – |

| 16:30 | GBP – Services PMI (Mar) | 61 | 61 | – |

| 18:00 | USD – ISM Non-Manufacturing PMI (Mar) | 56.5 | 58 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0970, 1.0895

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7550, 0.7660

Support level: 0.7395, 0.7280

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.15

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

040422 Afternoon Session Analysis

4 April 2022 Afternoon Session Analysis

Euro slumped amid bearish economic data.

The Euro received significant bearish momentum last week over the backdrop of a string of bearish economic data. According to Market economics, Germany Manufacturing Purchasing Managers Index notched down significantly from the previous reading of 57.6 to 56.9, missing the market forecast at 57.6. The German factory activity slumped to an 18-month low amid the negative impact from Russia-Ukraine, heightened the inflation risk in future. Fresh supply disruption due to the implementation of sanctions had increase the price for raw materials while constraining the factory production. Besides, the rising tensions between Russia-Ukraine had sparked further uncertainty to the world economy while weighing down the export sales. On the other hand, the Pound Sterling slumped last Friday following the release of downbeat data. According to Markit/CIPS, UK Manufacturing Purchasing Managers Index (PMI) came in at 55.2, which also fared worse than market expectation at 55.5. As of writing, EUR/USD depreciated by 0.02% to 1.1050 while GBP/USD slumped 0.03% to 1.3115.

In the commodities market, the crude oil price slumped 0.84% to 98.55 per barrel as of writing. The oil market edged lower following the United Arab Emirates and the Iran-aligned Houthi group decided to halt military operations on Saudi-Yemeni border, alleviating some concerns toward the oil supply issues. On the other hand, the gold price depreciated by 0.08% to $1923.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:05 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0895

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7395, 0.7280

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 101.50, 107.10

Support level: 97.15, 92.50

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

040422 Morning Session Analysis

4 April 2022 Morning Session Analysis

US Dollar surged amid bullish job data, spurring rate hike expectation.

The Dollar index which traded against a basket of six major currencies extend its gains last week over the backdrop of a string of bullish unemployment data from United States. According to Bureau of Labor Statistics, the US Nonfarm Payrolls data showed that the employers added another 431,000 jobs in March and the US Unemployment rate fell to 3.5%, indicating a strong run of hiring and the positive economic recovery from the United States. With the robust economic growth as well as spiking numbers of inflation rate, investors are widely expecting a significant rate hike from Federal Reserve in the year of 2022. The US Treasury Yield inverted once more on signs of persistent inflation rate, with short-term yields rise above long-term yields. As of writing, the Dollar Index appreciated by 0.26% to 98.55.

In the commodities market, the crude oil price extent its losses by 1.87% to 99.35 per barrel as of writing. The oil market continues to edge lower amid market participants remained concerns that the release of oil reserve from United States would likely to weigh down the crude oil price. On the other hand, the gold price depreciated by 0.63% to $1925.20 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:05 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0895

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7525, 0.7595

Support level: 0.7395, 0.7280

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 101.50, 107.10

Support level: 97.15, 92.50

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

010422 Afternoon Session Analysis

1 April 2022 Afternoon Session Analysis

Australia Dollar slump following passive economic data.

AUDUSD edged down since Thursday amid the backdrop of passive economic data of China. According to China Logistics Information Center, China Manufacturing Purchasing Managers Index (PMI) notched down from the previous reading of 50.2 to 49.5, lower than the market forecast of 49.9. China Manufacturing Purchasing Managers Index (PMI) provides an early indication each month of economic activities in the Chinese manufacturing sector. The data presented is compiled from the enterprises responses about their purchasing activities and supply situations. Hence, the upbeat index data would indicate a better economic prospect. Nonetheless, the index data did not meet market expectations, which dialed down the market optimism toward economic progression in China. As China is the largest trading partner for Australia, negative economic prospect in China would likely to drag down Australia economic momentum, prompting investors to selloff Australia Dollar as the market optimism toward Australia Dollar has been dialed down. Besides, Shanghai is set to put the vast majority of its residents under COVID lockdown from Friday, as it expands curbs to include the western half of the city and extends restrictions in the east, according to Reuters, spurring further bearish momentum on the pair. As of writing, AUDUSD depreciated by 0.04% to 0.7477.

In commodities market, crude oil price extend its losses by 0.40% to $99.88 per barrel as of writing following additional oil supply from President Biden. On the other hand, gold price depreciated by 0.75% to 1934.60 per troy ounces as of writing amid the strengthen of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 58.4 | 57.6 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 55.5 | 55.5 | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 5.90% | 6.50% | – |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 678K | 475K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.80% | 3.70% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1110, 1.1230

Support level: 1.1025, 1.0955

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7485, 0.7545

Support level: 0.7420, 0.7365

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9260, 0.9295

Support level: 0.9230, 0.9195

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 104.45, 108.40

Support level: 99.60, 95.35

GOLD_, H4: Gold price was traded lower following prior retracement from resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81

010422 Morning Session Analysis

1 April 2022 Morning Session Analysis

Safe-haven Dollar surged following the re-escalating tensions on Russia-Ukraine.

The Dollar Index which traded against a basket of six major currencies extend its rebounded following the re-escalating tensions between the Russia-Ukraine issues toward the global economic, which stoked a shift in sentiment toward safe-haven asset such as US Dollar. According to Reuters, Russian President Vladimir Putin yesterday forced to foreign buyers to pay in roubles for Russian gas beginning on Friday as he tries to tit-for-tat against the Western sanctions earlier. Since the European Union gets more than 30% of its oil usage from Moscow and 40% for national gas from Russia, the reiteration move from Russia would likely to trigger further tensions for the countries while leading to spill over effect toward the global economy. Nonetheless, a senior Ukrainian official claimed that the peace negotiations between Moscow and Kyiv will resume on Friday. Investors would remain their focus toward the talks to receive further trading signal. As of writing, the Dollar Index appreciated by 0.57% to 98.35.

In the commodities market, the oil price slumped significantly following US President Joe Biden announced the largest ever release from the US Strategic Petroleum Reserve to boost up the oil supply while stabilize the inflation risk in future. On the other hand, the gold market depreciated by 0.07% to $1936.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 58.4 | 57.6 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 55.5 | 55.5 | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 5.90% | 6.50% | – |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 678K | 475K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.80% | 3.70% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0895

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 101.50, 107.10

Support level: 97.15, 92.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

310322 Afternoon Session Analysis

31 March 2022 Afternoon Session Analysis

Euro surged following additional oil form Biden.

The Euro extend its gains on Wednesday over the backdrop of surging oil supply from President Joe Biden. According to Reuters, The Biden administration is weighing a draw of oil from emergency reserves of up to 180 million barrels over several months, two U.S. sources said on Wednesday. The move is an attempt to control oil prices that have shot over $100 a barrel on Russia’s invasion of Ukraine and on high global demand. The rising tensions of Russia-Ukraine conflict would likely to cause inflation risk to surge, as the economic activities was restricted, leading to the spike of commodities price such as crude oil. The move attempted by Biden would pump additional oil circulation into commodities market and the companies in Europe region was benefited as the impost cost was diminished. It dialed up the market optimism toward economic progression in Europe region, leading investors to purchase Euro which having better future prospects, spurring further bullish momentum on the pair. As of writing, Euro appreciated by 0.10% to 1.1167.

In commodities market, crude oil price depreciated by 5.69% to $101.69 per barrel as of writing following President Biden decided to release oil from emergency reserve. Besides, gold depreciated by 0.47% to $1924.50 per troy ounces as of writing amid the backdrop of diminishing of inflation risk had drag down the inflation-hedging commodities.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q4) | 1.10% | 1.00% | – |

| 14:00 | GBP – GDP (YoY) (Q4) | 6.50% | 6.50% | – |

| 15:55 | EUR – German Unemployment Change (Mar) | -33K | -20K | – |

| 20:30 | USD – Initial Jobless Claims | 187K | 200K | |

| 20:30 | CAD – GDP (MoM) (Jan) | 0.00% | 0.20% |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 97.95, 99.10

Support level: 96.80, 95.70

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1230, 1.1315

Support level: 1.1110, 1.1025

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 122.35, 124.05

Support level: 121.30, 118.90

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7485, 0.7545

Support level: 0.7420, 0.7365

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9260, 0.9295

Support level: 0.9230, 0.9195

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 104.45, 108.40

Support level: 99.60, 95.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81

310322 Morning Session Analysis

31 March 2022 Morning Session Analysis

US Dollar retreated following US GDP growth revised lower.

The Dollar Index which traded against a basket of six major currencies extend its losses over the backdrop of downbeat economic data yesterday. The United States economy ended 2021 by expanding at a 6.9% annual pace from October through December, according to Bureau of Economic Analysis. Nonetheless, the overall reading is still slight downgrade from its previous estimation. Economist predicted that the growth in future is likely to slow sharply in the year of 2022 as spiking numbers of inflation rate prompted by the earlier aggressive expansionary monetary policy would likely to weigh down on consumer spending. On top of that, the US Home Sales have fallen following the Federal Reserve has started the implementation of rate hike, leading to a sharp increase in borrowing costs. Exports may weaken as overseas economies are disrupted by Russia’s invasion of Ukraine. As of writing, the Dollar Index depreciated by 0.57% to 97.98.

In the commodities market, the crude oil price surged 0.08% to $108.95 per barrel as of writing following the released of the bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -3.449M, better than the market forecast at -1.022M. On the other hand, the gold price surged 0.02% to $1932.95 per troy ounces as of writing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q4) | 1.10% | 1.00% | – |

| 14:00 | GBP – GDP (YoY) (Q4) | 6.50% | 6.50% | – |

| 15:55 | EUR – German Unemployment Change (Mar) | -33K | -20K | – |

| 20:30 | USD – Initial Jobless Claims | 187K | 200K | |

| 20:30 | CAD – GDP (MoM) (Jan) | 0.00% | 0.20% |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1245, 1.1370

Support level: 1.1135, 1.0980

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.15

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

300322 Afternoon Session Analysis

30 March 2022 Afternoon Session Analysis

Euro spiked following peace talks between Russia-Ukraine.

The Euro extend its gains on Wednesday over the backdrop of Russia-Ukraine peace talks on yesterday. According to Reuters, Russia appeared a speech on Tuesday, which promised to scale down military operations around Kyiv and another city. Nonetheless, Russia has started moving very small numbers of troops away from positions around Kyiv in a move that is more of a repositioning than a retreat or a withdrawal from the war, according to the Pentagon. The easing tensions of Russia invasion of Ukraine would likely to relieve sanction imposed on Russia by other countries such as US, leading to the slump of commodities price such as crude oil. Diminishing of crude oil price would reduce companies’ import cost in Europe region, as Europe is the most dependent on Russia oil. It dialed up the market optimism toward economic progression in Europe region, prompting investors to purchase Euro which having better prospects, spurring further bullish momentum on Euro. Investors should continue to scrutinize the latest updates with regards of Russia-Ukraine peace talks in order to receive further trading signals on the pair. As of writing, Euro appreciated by 0.22% to 1.1109.

In commodities market, crude oil price appreciated by 0.58% to $104.84 per barrel as of writing. Nonetheless, oil price remained under pressure following Russia-Ukraine peace talks. Besides, gold appreciated 0.57% to 1923.15 per troy ounces as of writing. However, gold remained bearish amid the backdrop of peace negotiations between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 475K | 438K | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 2.30% | 7.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -2.508M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1230, 1.1315

Support level: 1.1110, 1.1025

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 122.35, 124.05

Support level: 121.30, 118.90

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7545, 0.7595

Support level: 0.7485, 0.7420

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9295, 0.9335

Support level: 0.9260, 0.9230

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 108.40, 113.35

Support level: 104.45, 99.60

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81

300322 Morning Session Analysis

30 March 2022 Morning Session Analysis

De-escalating tensions upon Russia-Ukraine, safe-haven dipped.

The Dollar Index which traded against a basket of six major currencies slumped significantly yesterday amid the easing tensions from Russia-Ukraine had stoked a shift in sentiment toward other riskier asset, dragging down the appeal for the safe-haven Dollar. According to the Guardian, Russia has pledged to drastically reduce its military activity in northern Ukraine to help advance peace talks. Russia’s deputy defence minister, Alexander Fomin, said after the talks in Istanbul on Tuesday that Russia wanted to increase mutual trust, create the right conditions for future negotiations and reach the final aim of signing a peace deal with Ukraine”. Besides, Ukraine President Volodymyr Zelenskiy claimed that the signals from the talks are still remained positive. Nonetheless, Russian Top negotiator Medinsky claimed that the de-escalation does not mean both parties would ceasefire, while reiterated that it still required further talks to enhance the relationship between Russia-Ukraine. As of writing, the Dollar Index depreciated by 0.69% to 98.40.

In the commodities market, the crude oil price retreated 0.05% to $107.00 per barrel as of writing. The oil market edged lower yesterday amid the hopes upon the resolution of Russia-Ukraine war had sparked positive prospect toward the oil supply disruption issues. On the other hand, the gold price depreciated by 0.08% to $1917.95 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 475K | 438K | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 2.30% | 7.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -2.508M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.1135, 1.1245

Support level: 1.0985, 1.0895

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.40, 125.55

Support level: 119.90, 116.15

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6975.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after successfully breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 107.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.15

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1912.60. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

290322 Afternoon Session Analysis

29 March 2022 Afternoon Session Analysis

Japanese Yen remained bearish amid dovish expectation from BoJ.

The USDJPY edged down from its recent high since Monday. Nonetheless, the overall trend of the pair remained bullish amid the backdrop of Bank of Japan retains dovish stance. According to Reuters, the Bank of Japan (BoJ) intervened to stop government bond yields from rising above its key target, while rising U.S. yields pushed the dollar higher against other currencies too. The BoJ, which has repeatedly said it is committed to keeping monetary policy loose on Monday, made two offers to buy an unlimited amount of government bonds with maturities of more than five years and up to 10 years. Bond buying program from BoJ bonds would likely to increase Japanese Yen supply in the market, dialing down the market optimism toward Japanese currency. It prompted investors to selloff Japanese Yen and purchase other currencies with better prospects such as US Dollar, spurring further bearish momentum on Yen. As of writing, USDJPY depreciated by 0.43% to 123.38.

In commodities market, crude oil price depreciated by 0.75% to $105.19 per barrel as of writing following drop in fuel demand in China after the financial hub of Shanghai shut down to curb a surge in COVID-19 cases. On the other hand, gold extend its losses by 0.75% to $1925.20 per troy ounces as of writing as Ukraine was hoping to have peace talks with Russia in over two weeks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 110.5 | 107 | – |

| 22:00 | USD – JOLTs Job Openings (Feb) | 11.263M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1025, 1.1110

Support level: 1.0945, 1.0900

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 124.05, 125.15

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7545, 0.7595

Support level: 0.7485, 0.7420

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

USDCHF, H4: USDCHF was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9380, 0.9415

Support level: 0.9335, 0.9295

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 108.40, 113.35

Support level: 104.45, 99.60

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81

290322 Morning Session Analysis

29 March 2022 Morning Session Analysis

US Dollar surged as rising US yield.

The Dollar Index which traded against a basket of six major currencies hovered in recent high amid market participants continue to speculate the rate hike expectation from Federal Reserve, sending the US Treasury yields soared to new multi-year highs. According to Reuters, US 10-year Treasury yield surged above 2.5% to three-year highs, with the expectation that the Federal Reserve would likely to implement a 50 basis-point interest rate rise in May in order to stabilize the spiking numbers of inflation rate. Nonetheless, the overall trend for the US Dollar for yesterday remained stable as investors are currently still waiting for the crucial jobs data from the United States on Friday. Meanwhile, investors would continue to scrutinize the latest updates of the monetary policy decision as well as further economic data to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.34% to 99.15.

In the commodities market, the crude oil price appreciated by 0.43% to $105.36 per barrel as of writing amid technical correction. Though, the overall trend for the crude oil price remained bearish as the fears of demand disruption following the implementation of lock-down in China continue to weigh down the appeal for this black-commodity. On the other hand, the gold price depreciated by $1923.80 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 110.5 | 107 | – |

| 22:00 | USD – JOLTs Job Openings (Feb) | 11.263M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0985, 1.0895

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 125.55, 128.20

Support level: 122.95, 119.90

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 105.80, 109.90

Support level: 100.70, 97.15

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1912.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35

280322 Afternoon Session Analysis

28 March 2022 Afternoon Session Analysis

Euro slumped amid downbeat data.

The Euro slumped over the backdrop of bearish economic data last week. According to Ifo Institute for Economic Research, Germany Ifo Business Climate Index notched down significantly from the previous reading of 98.5 to 90.8, missing the market forecast at 94.2. The downbeat reading indicated that the market expectations toward the business outlook in the European region is extremely uncertain due to the rising tensions between Russia-Ukraine recently. Besides that, the Euro extend its losses amid escalating tensions between Russia-Ukraine during the weekend. According to Reuters, the war tensions between Russia-Ukraine remained high following the rockets missiles continue to strike the western Uranian city of LVIV on Saturday, signalling a new potential new front in Moscow’s invasions. Meanwhile, United States and NATO claimed that they will continue to support Ukraine with military and humanitarian assistance while imposing significant economic sanctions upon Russia. As of writing, the EURUSD depreciated by 0.26% to 1.0953.

In the commodities market, the crude oil price slumped 1.85% to $112.25 per barrel as of writing. The oil market edged lower following the implementation of China lockdown in order to combat the spiking numbers of Covid-19 cases, weighing down the prospect for the oil demand in future. On the other hand, the gold price depreciated by 0.55% to $1947.15 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3285

Support level: 1.3125, 1.3010

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0985, 1.1135

Support level: 1.0895, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 122.95. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 114.00, 119.85

Support level: 109.90, 105.80

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1944.55. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60

280322 Morning Session Analysis

28 March 2022 Morning Session Analysis

US Dollar surged amid US latest Fiscal plan.

The Dollar Index which traded against a basket of six major currencies extend its gains following US President Joe Biden propose a minimum tax on billionaires as part of the fiscal policy for the year of 2023. Further details are expected to be unveiled on Monday, according to White House. The fiscal policy plan would set at 20% minimum tax rate on households who worth more than $100 million, targeting the United State’s billionaires. According to US authorities, the plan would authorize those wealthy household to pay the minimum tax of 20% on all their incoming including unrealized investment income. The contractionary fiscal policy will help to reduce the current budget deficit by about $360 billion in the next decade, protecting the economic growth for the Unites States. As of writing, the Dollar Index appreciated by 0.02% to 98.81.

In the commodities market, the crude oil price extends its gains by 1.18% to 114.45 per barrel as of writing. The oil market continues to edge higher amid traders reconciled the impact of missile attack on an oil facility in Saudi Arabia. Yemen’s Houthis claimed that they launched attacks on Saudi energy facilities on Friday. On the other hand, the gold price appreciated by 0.02% to $1958.20 as of writing amid rising tensions between Russia-Ukraine continue to spark higher inflation risk in future.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3285

Support level: 1.3125, 1.3010

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0985. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 122.95. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 114.45, 120.10

Support level: 110.45, 106.45

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1946.35, 1912.60