250322 Afternoon Session Analysis

25 March 2022 Afternoon Session Analysis

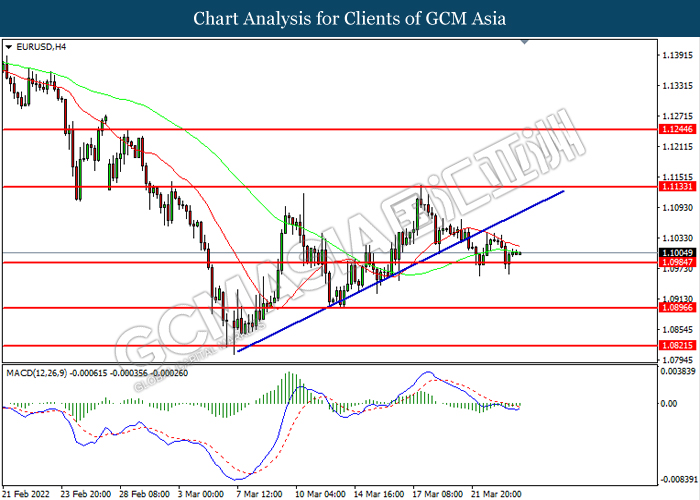

Euro surged following EU and US deal.

The Euro started rebounding since Thursday amid the backdrop of European Union accepting US commodities. According to Reuters, the European Union and United States are set to unveil a deal on Friday to supply Europe with more U.S. liquefied natural gas (LNG), as the European bloc seeks to quickly curb its reliance on Russian fossil fuels. President Joe Biden, who attended the EU leaders summit in Brussels on Thursday, promised the United States would deliver at least 15 billion cubic metres (bcm) more LNG to Europe this year than planned before. By banning Russia commodities from US, it led to the spike of commodities price and causing the hike of import cost in European region as Russia was the top commodities supplier for Europe. Accepting US commodities would likely to overcome the commodities disruption in Europe, dialing up the market optimism toward economic progression in Europe, and it prompted investors to purchase Euro. Besides, Germany Manufacturing Purchasing Managers Index (PMI) came in with the reading of 57.6, which exceeding the market forecast of 55.8, according to Markit Economics. The upbeat economic data brought positive prospects toward economic momentum in Europe, spurring further bullish momentum on the pair. As of writing, EURUSD appreciated by 0.31% to 1.1030.

In commodities market, crude oil price appreciated by 0.04% to $112.38 per barrel as of writing. Nonetheless, oil price was under pressure over the backdrop of US supply commodities to EU. On the other hand, gold appreciated by 0.01% to $1962.25 per troy ounces as of writing under rising tensions between Russia-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Feb) | 1.90% | 0.80% | – |

| 17:00 | EUR – German Ifo Business Climate Index (Mar) | 98.9 | 94 | – |

| 22:00 | USD – Pending Home Sales (MoM) (Feb) | -5.70% | 1.50% | – |

Technical Analysis

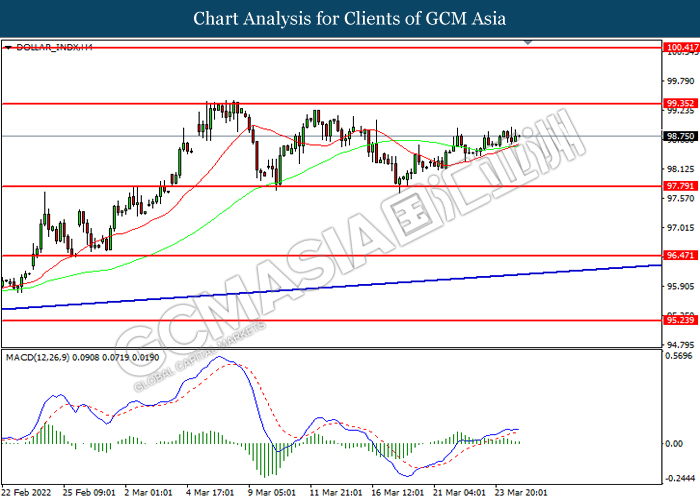

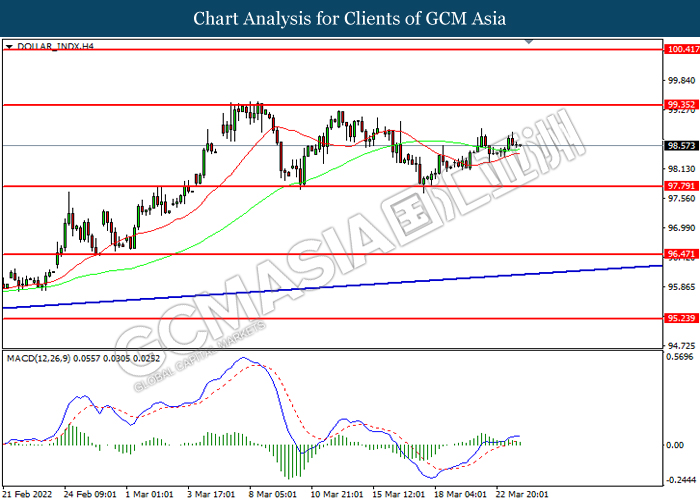

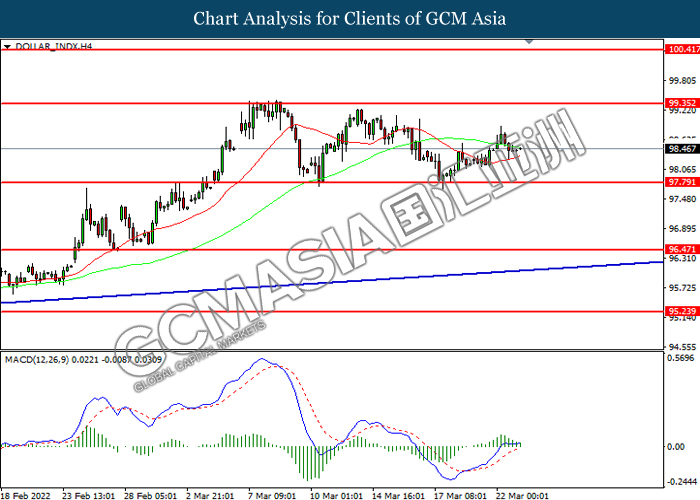

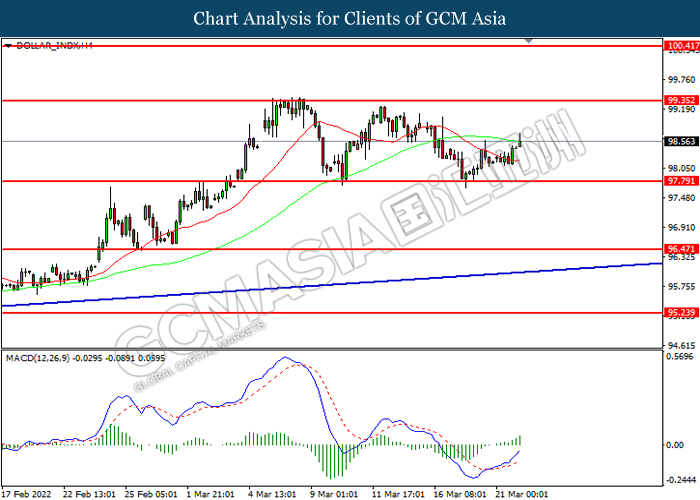

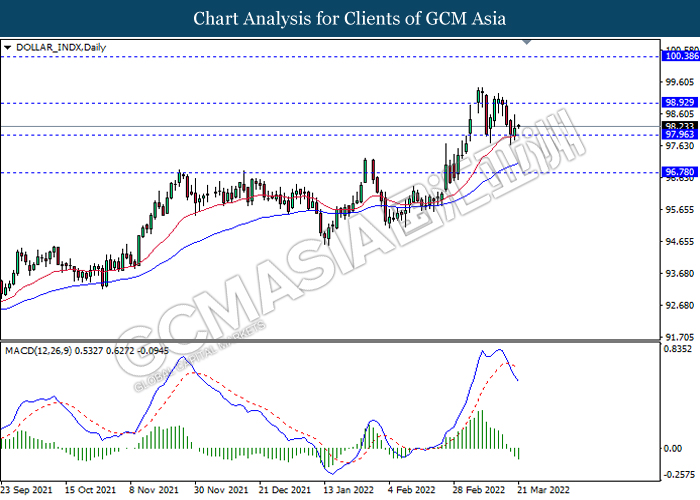

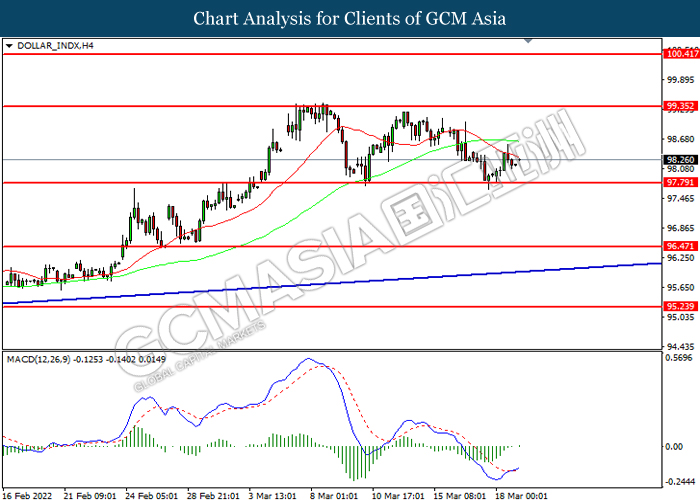

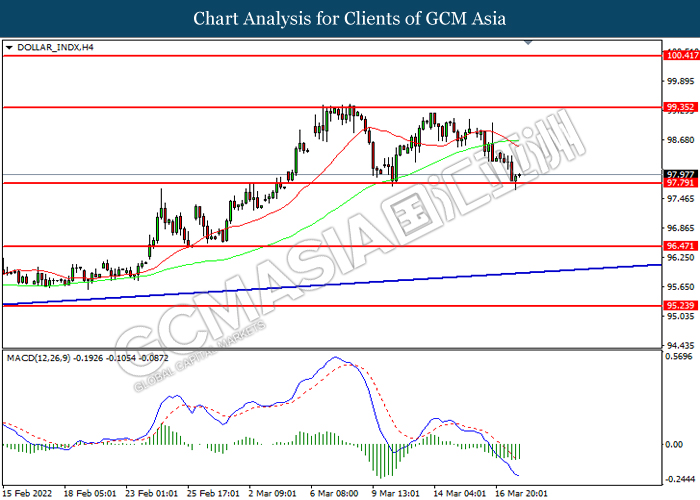

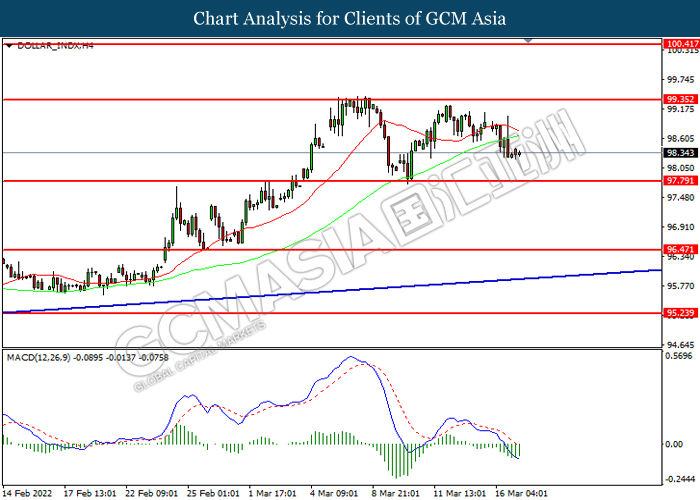

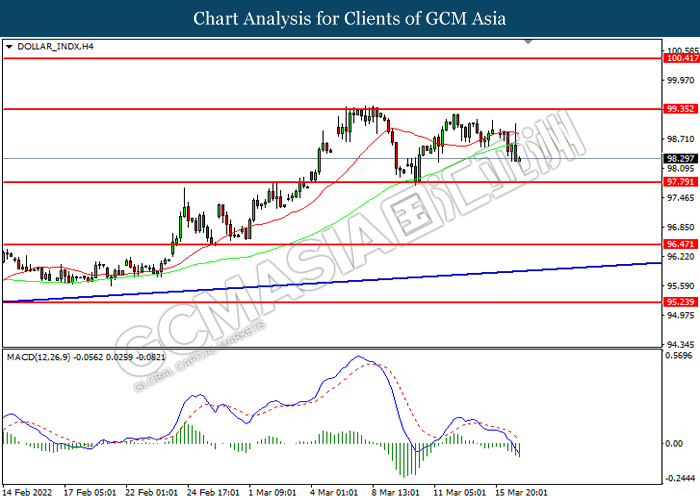

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

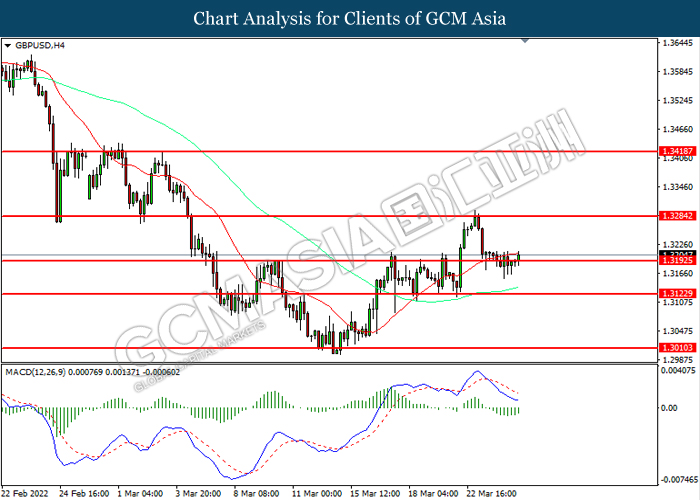

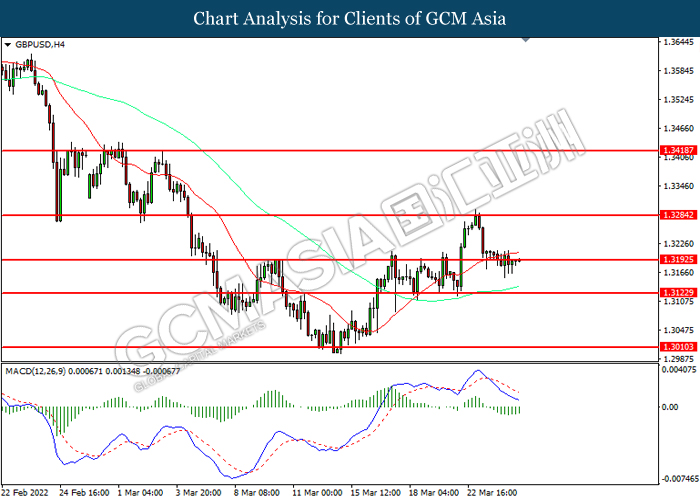

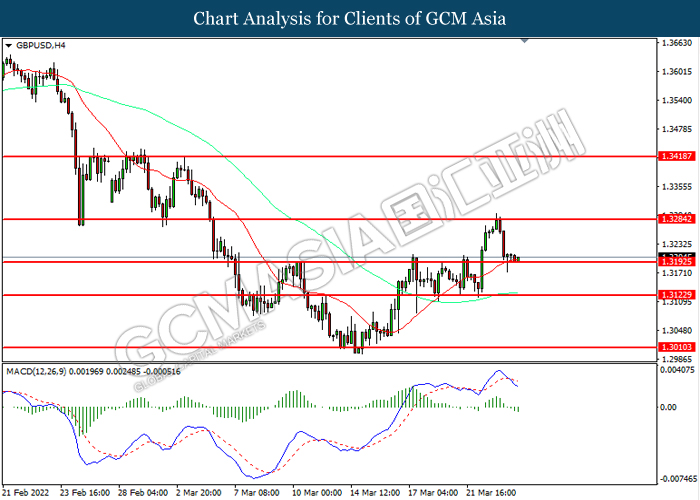

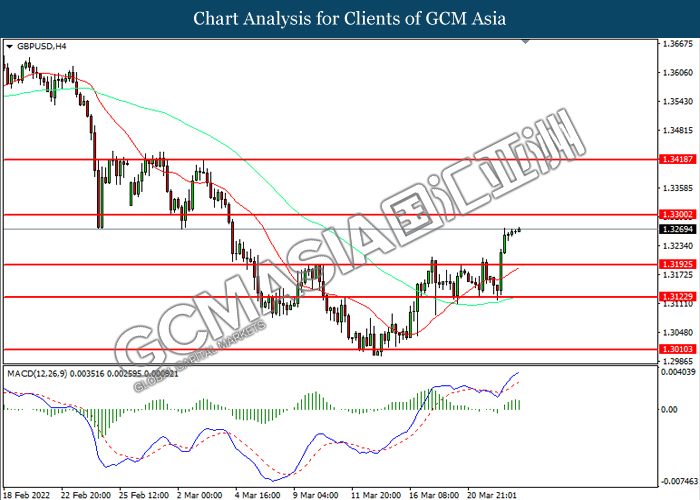

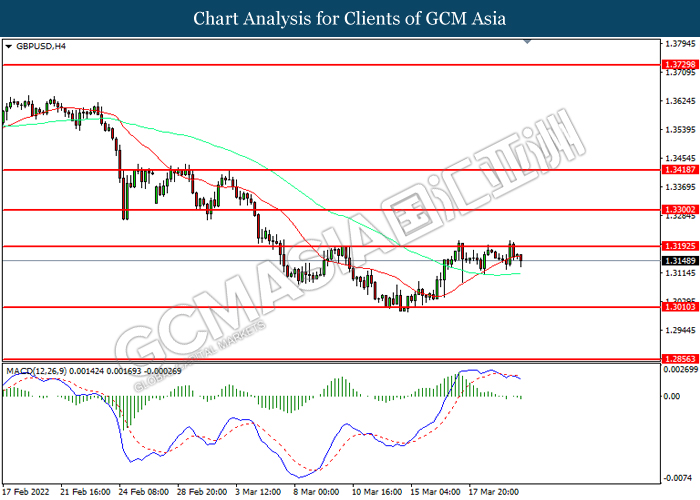

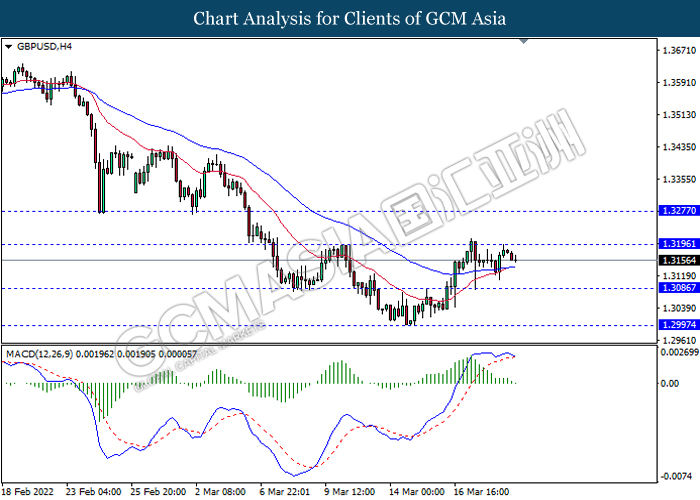

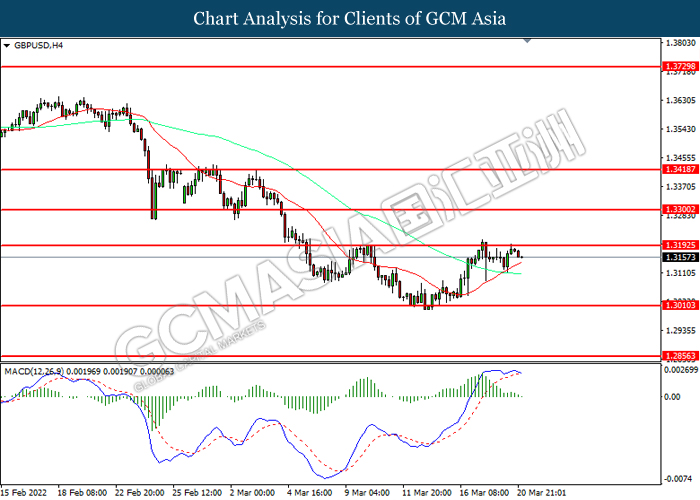

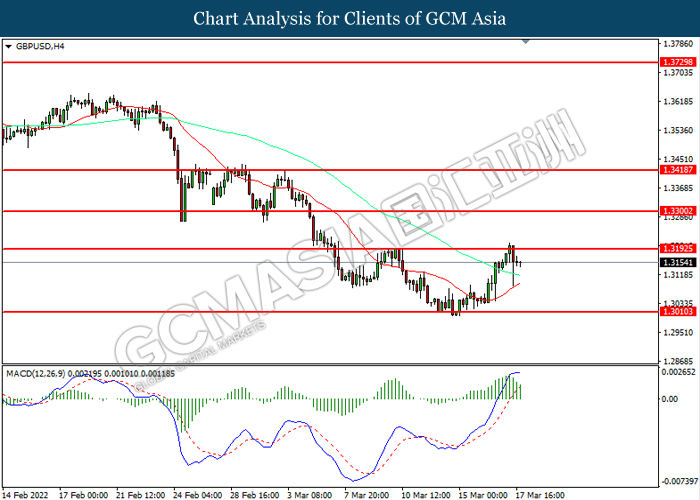

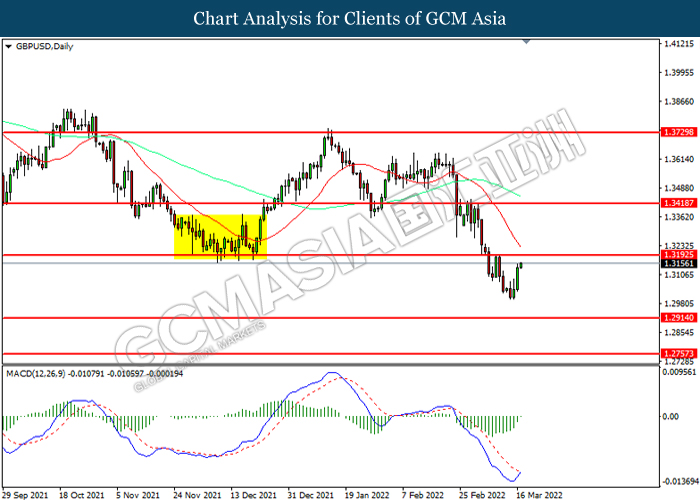

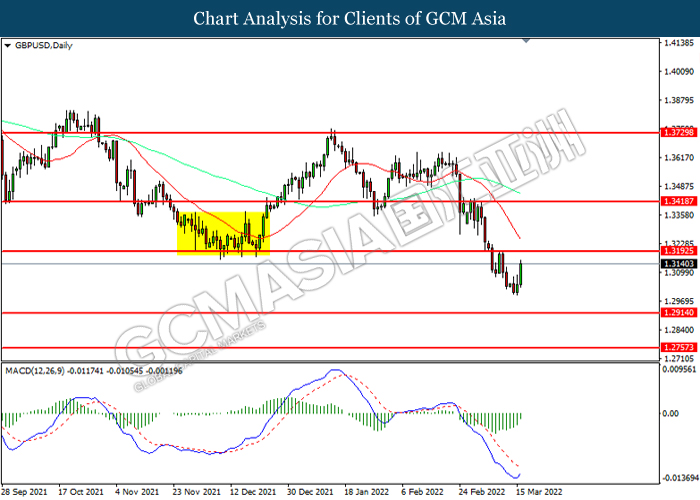

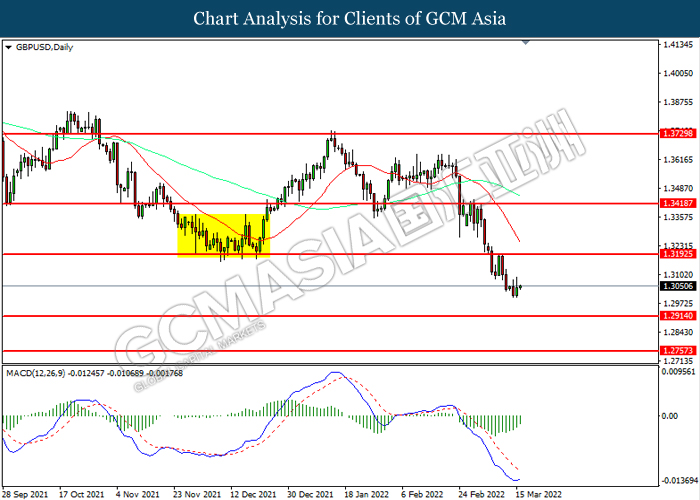

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3285, 1.3420

Support level: 1.3195, 1.3125

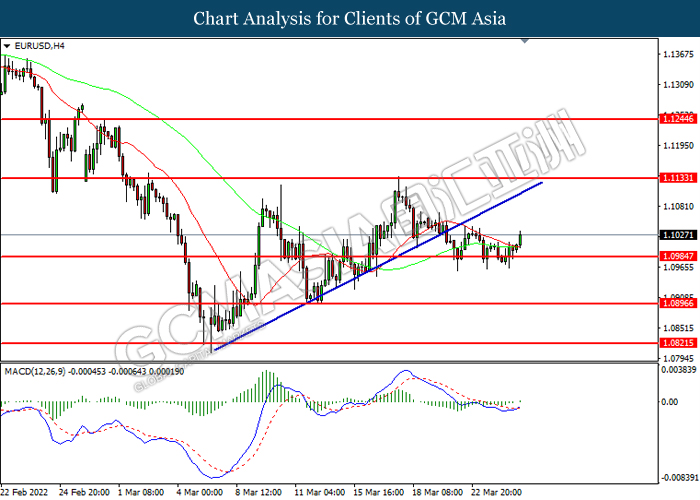

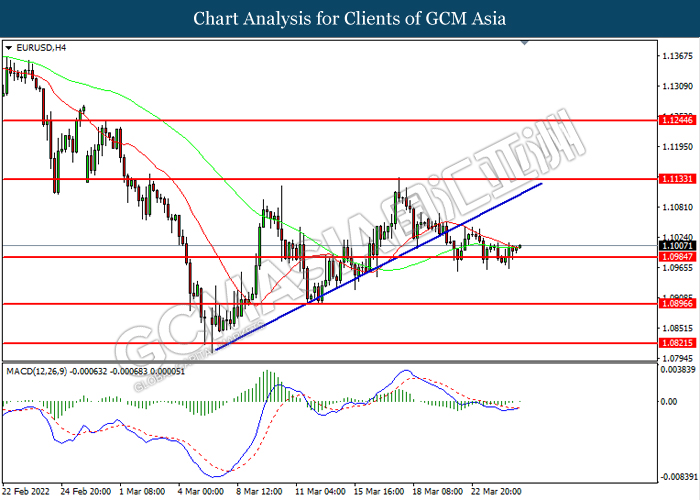

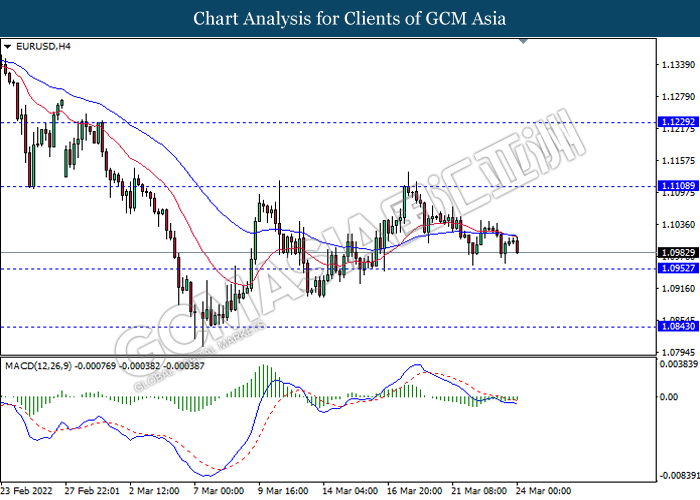

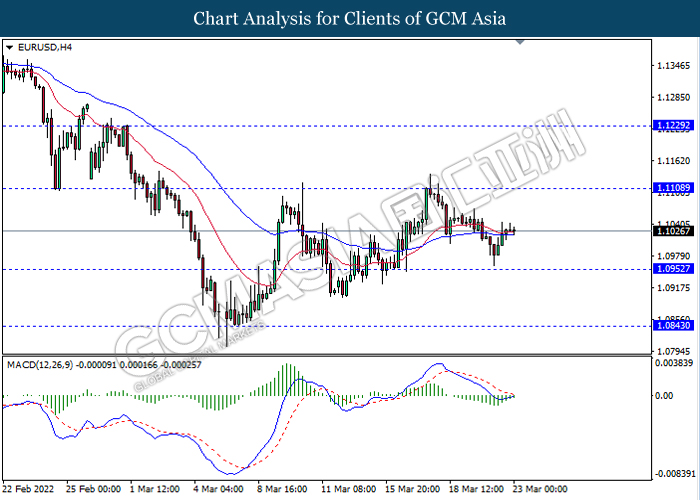

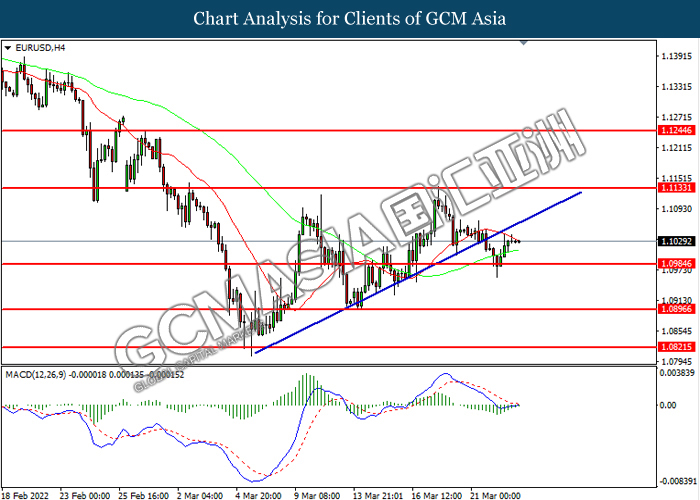

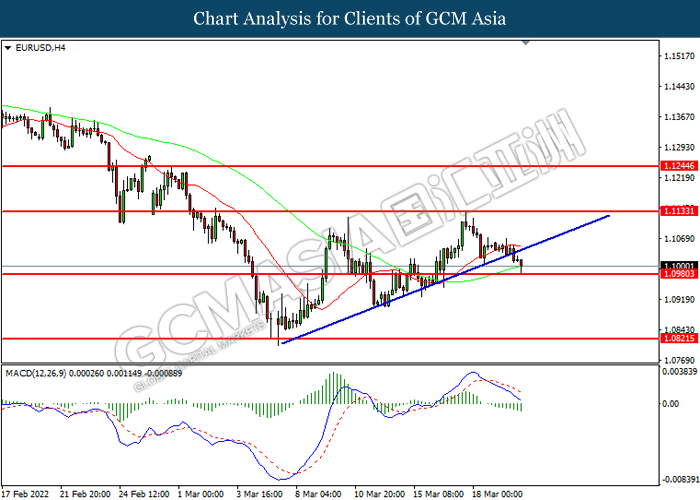

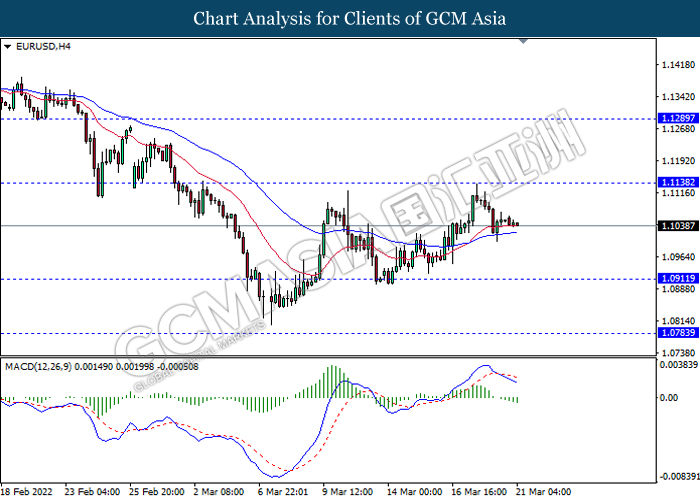

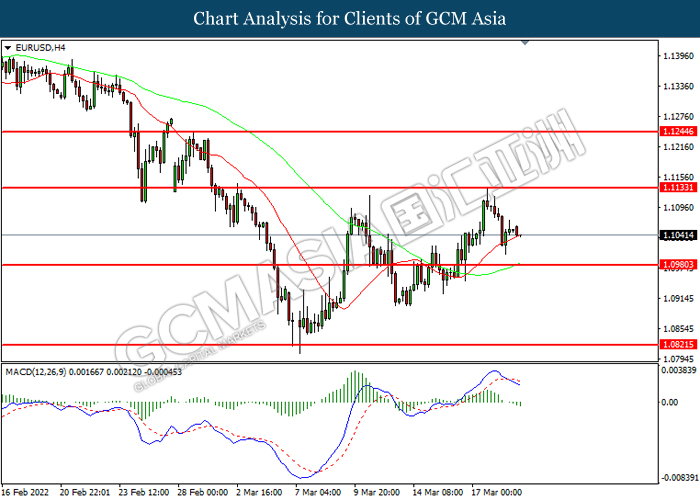

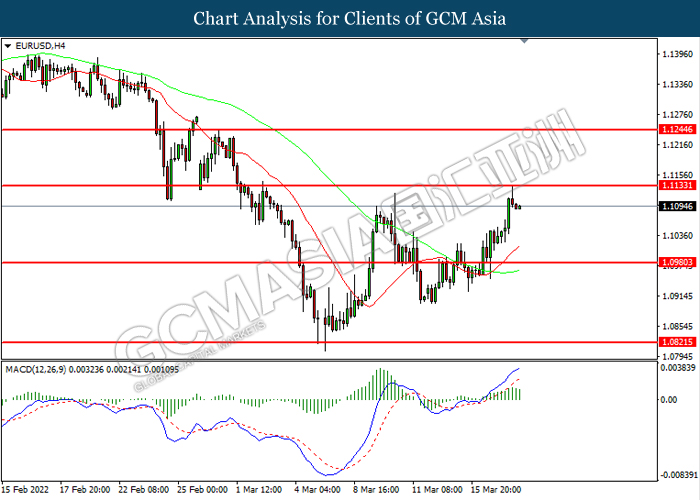

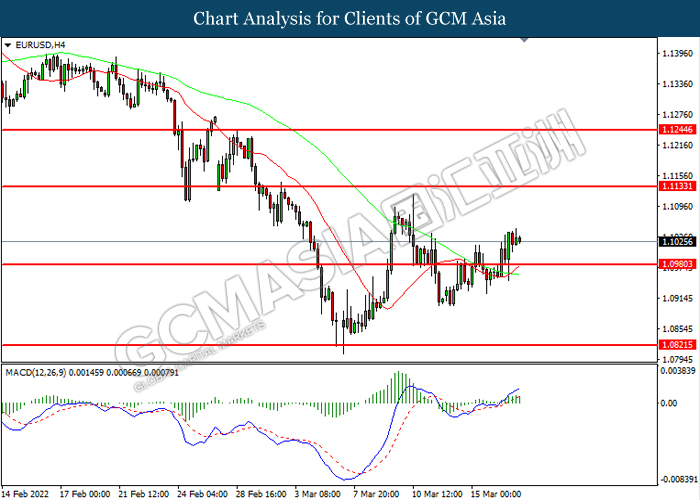

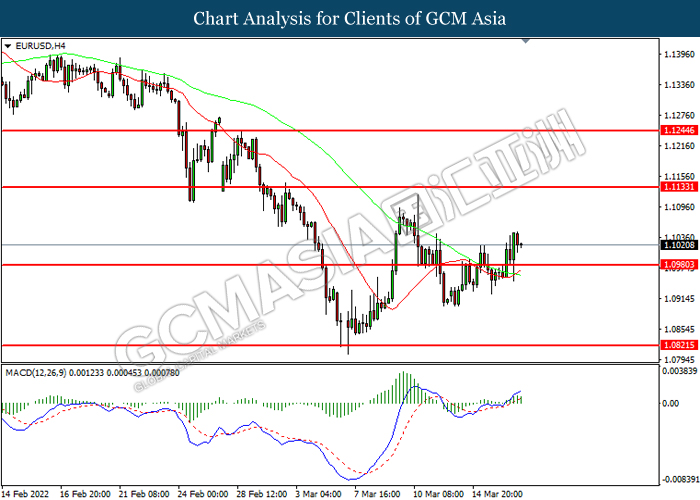

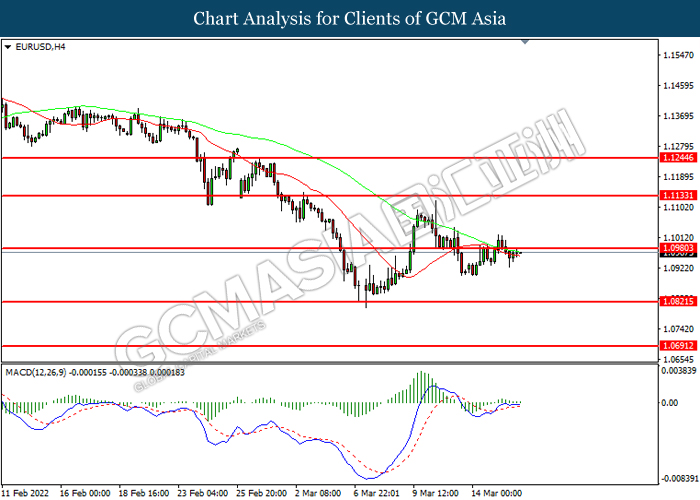

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

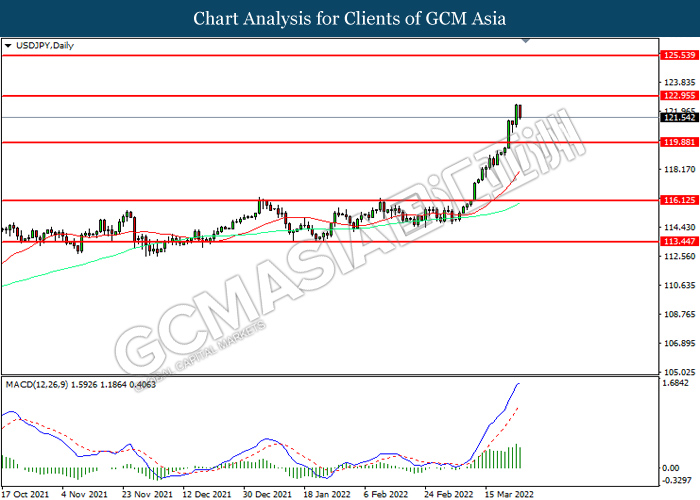

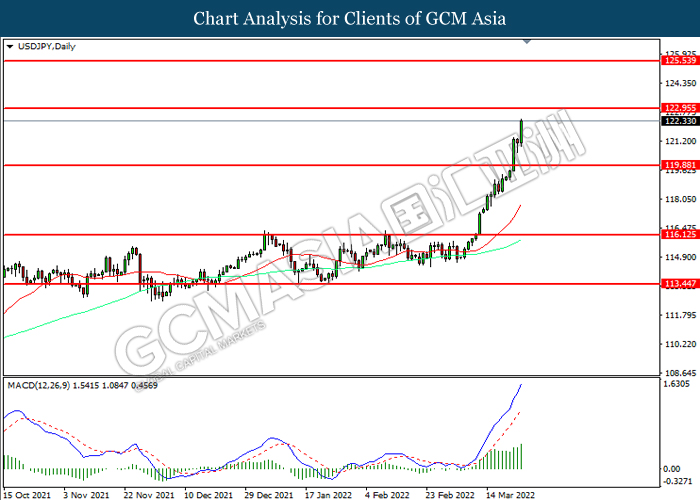

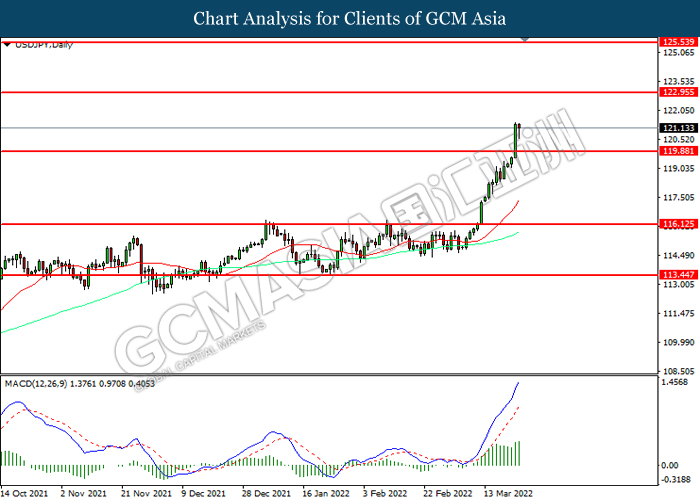

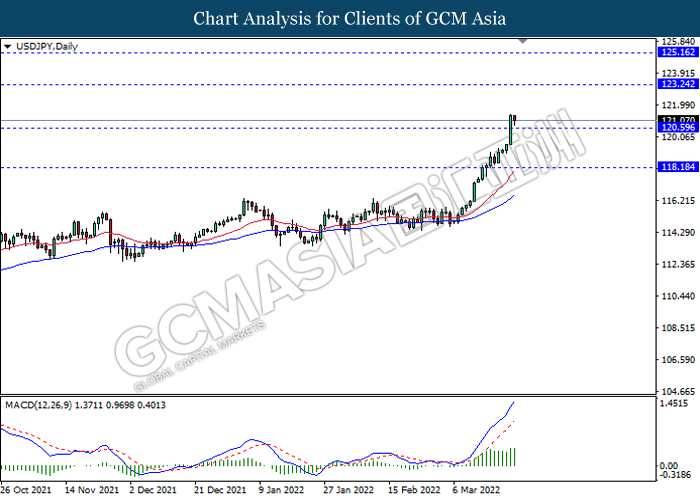

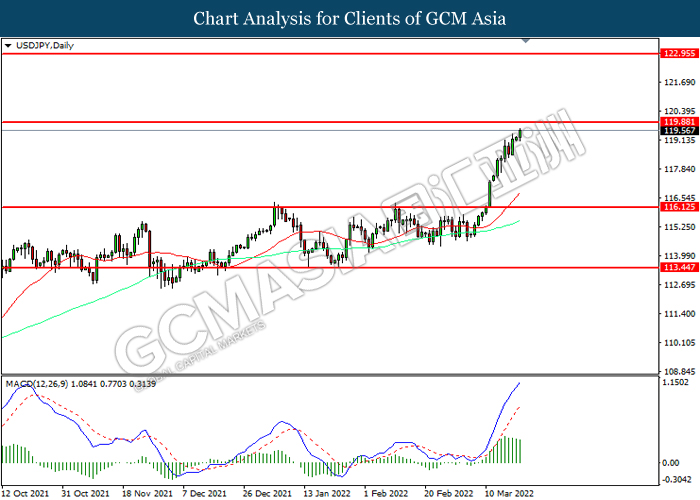

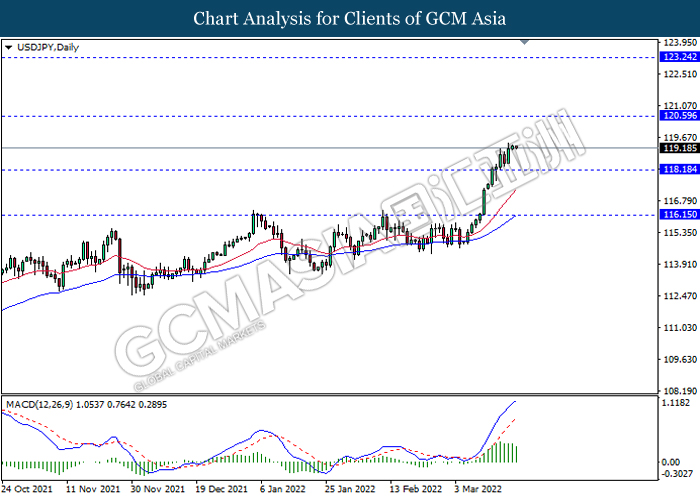

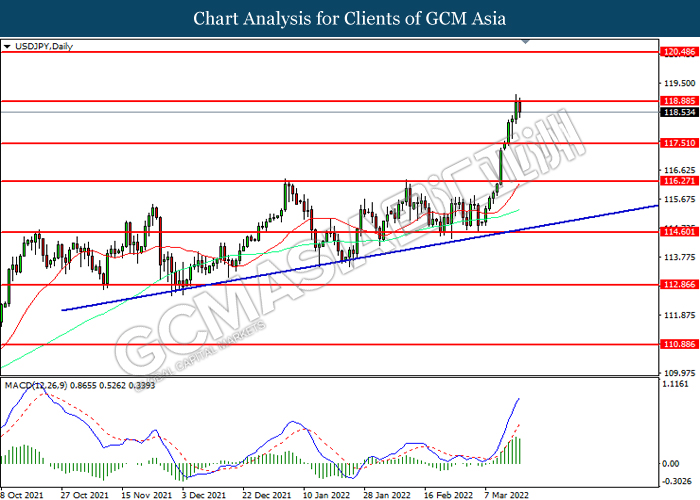

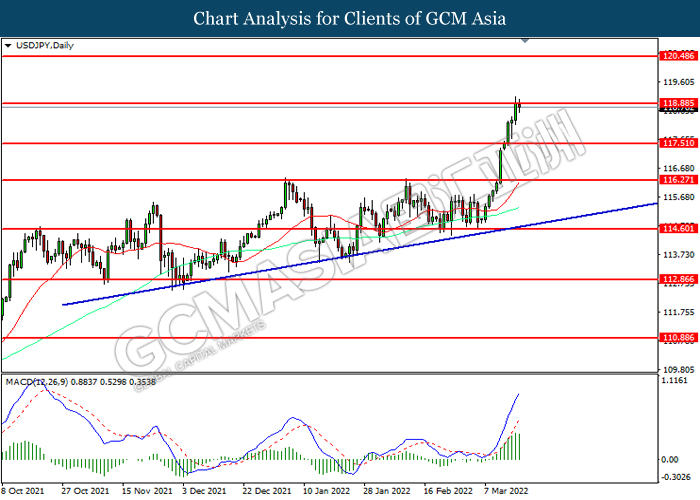

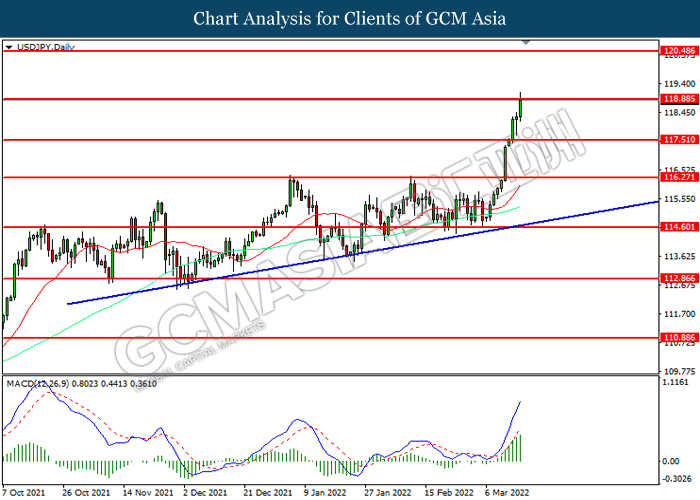

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

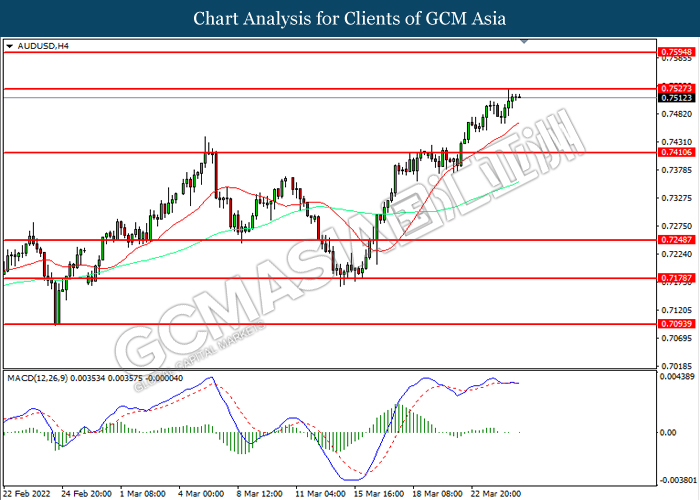

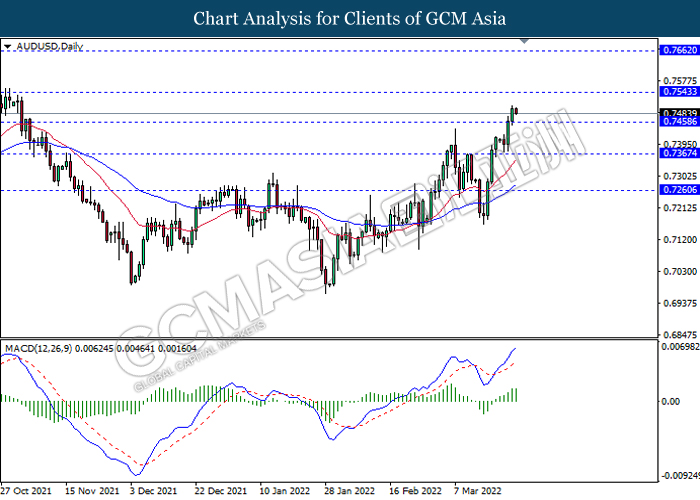

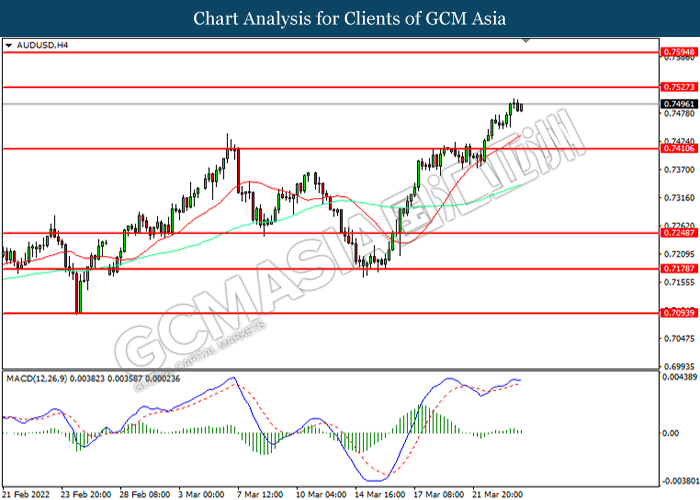

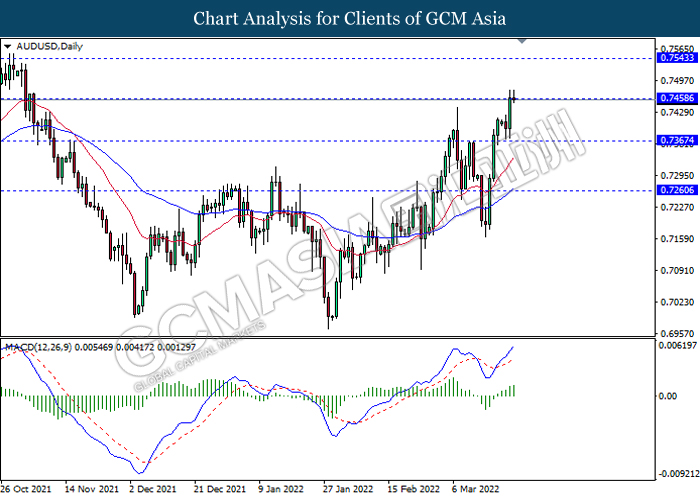

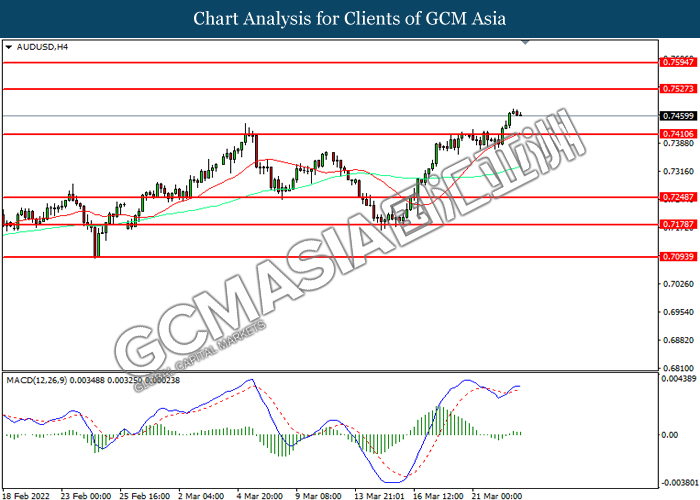

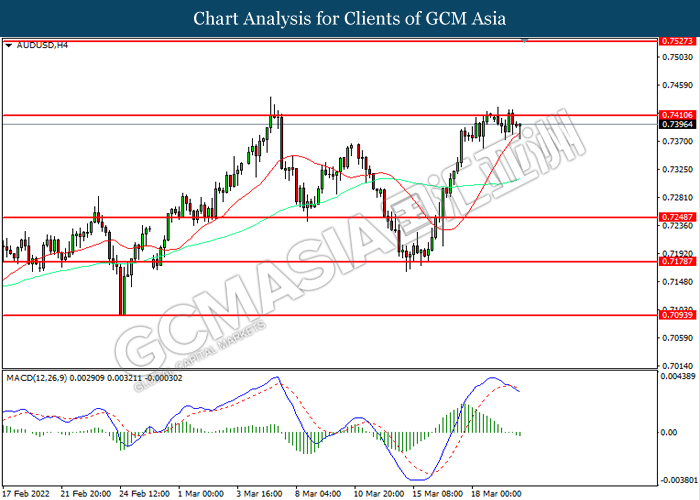

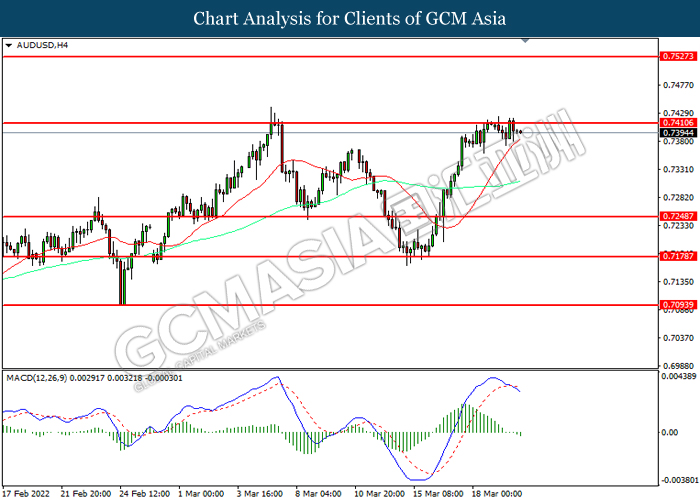

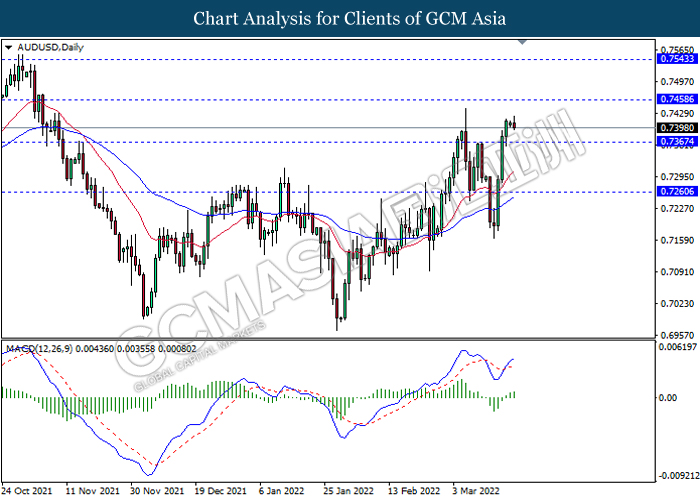

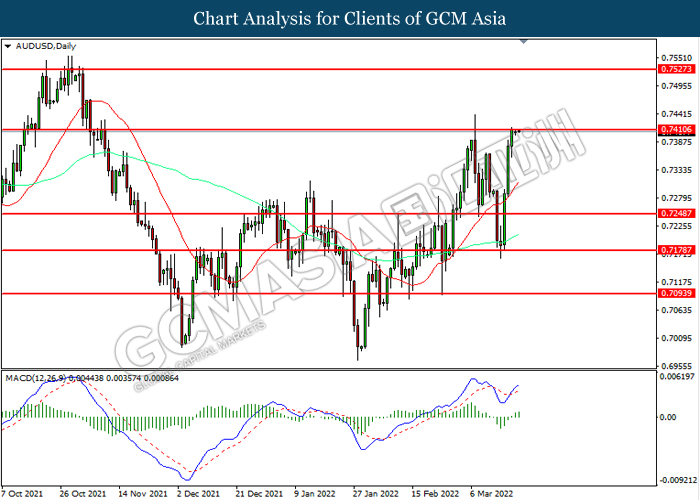

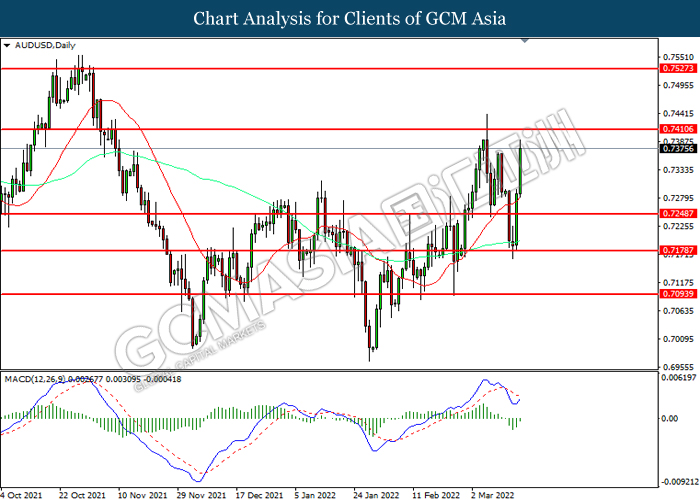

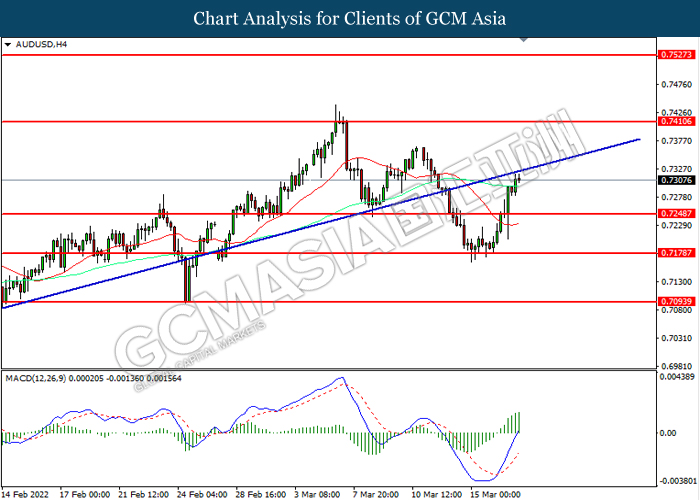

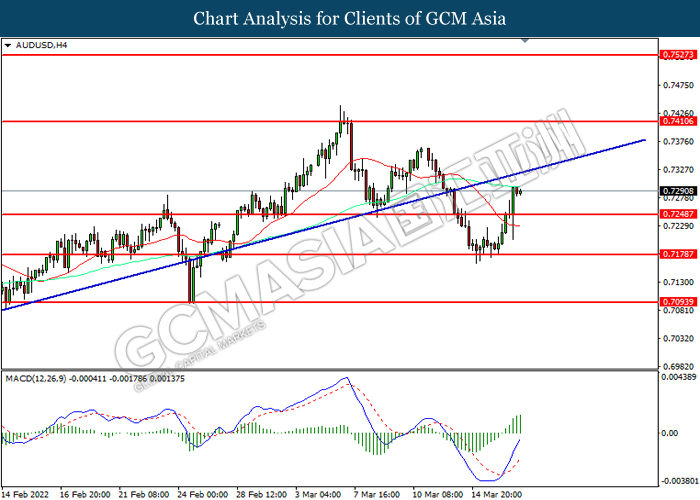

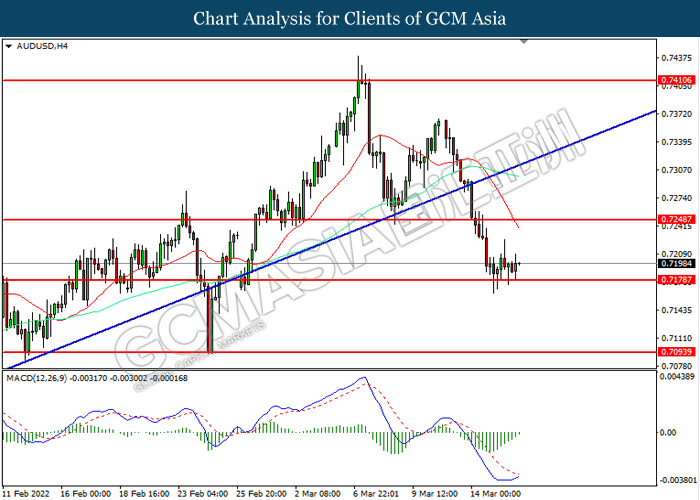

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

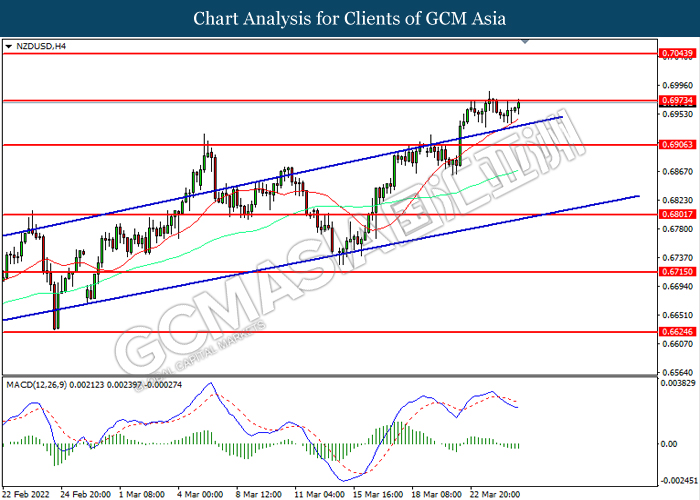

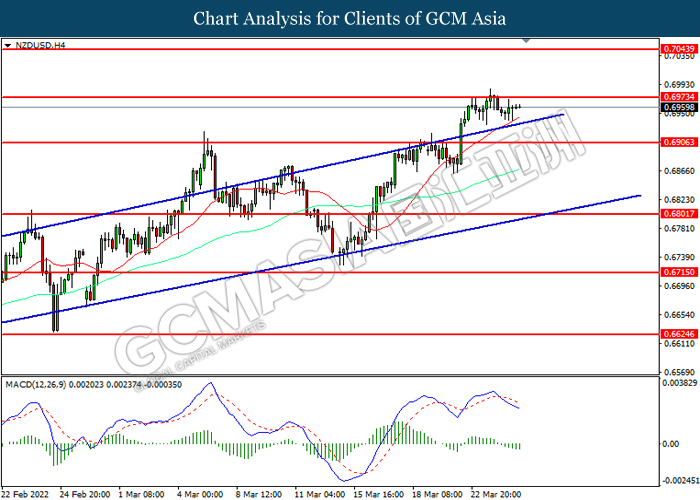

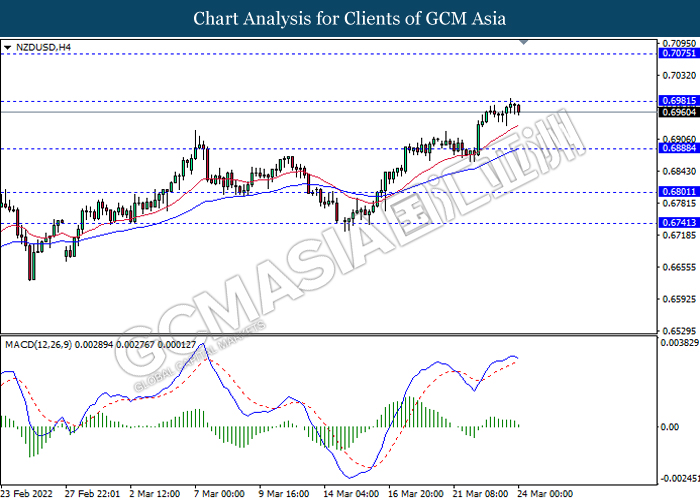

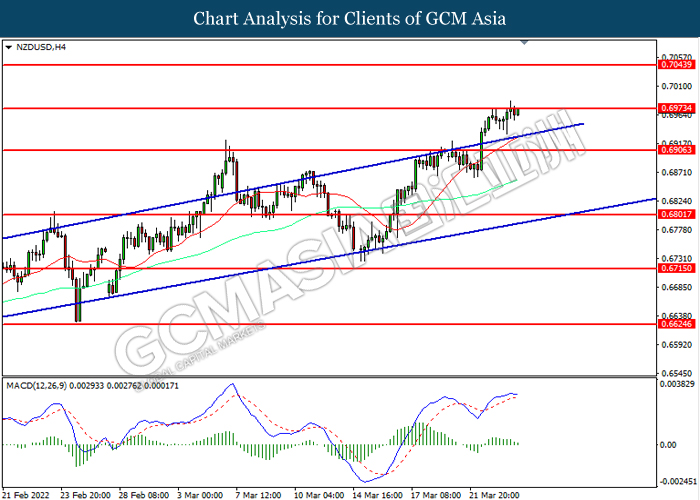

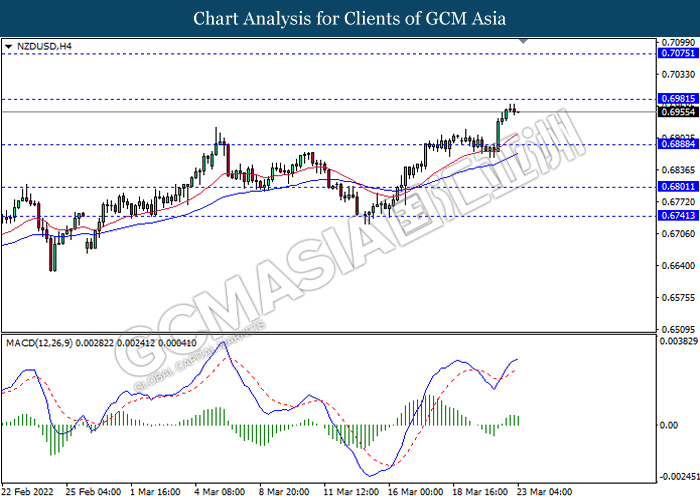

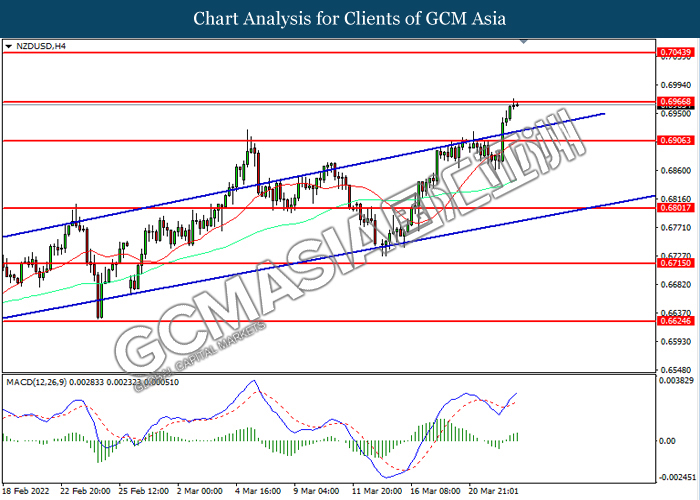

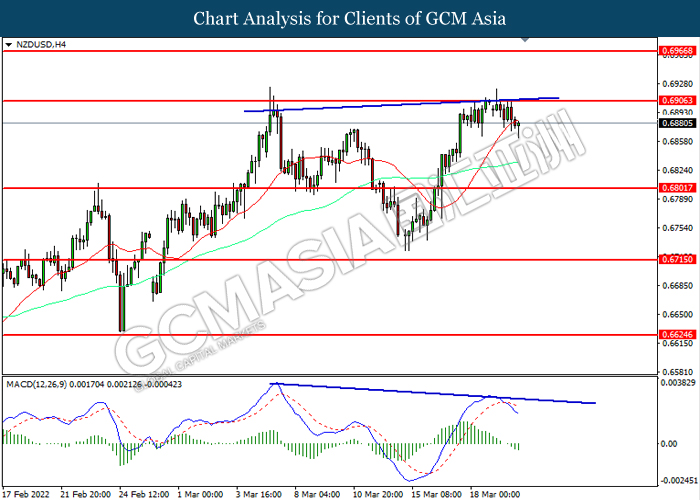

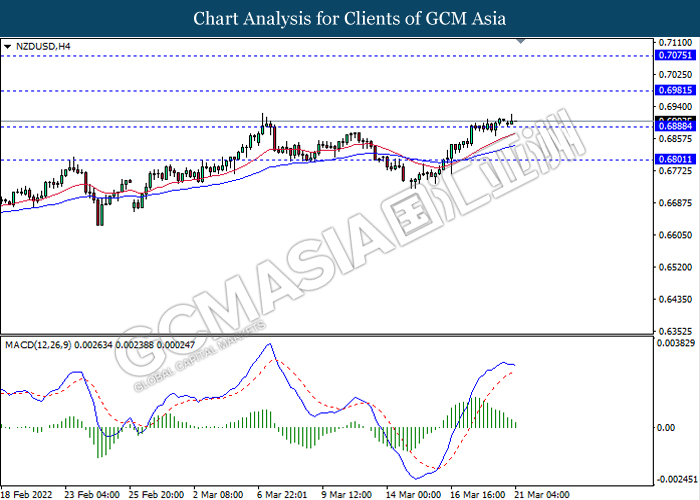

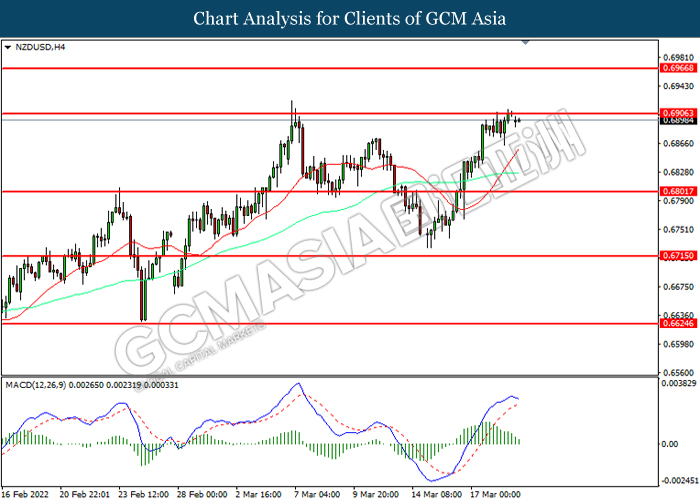

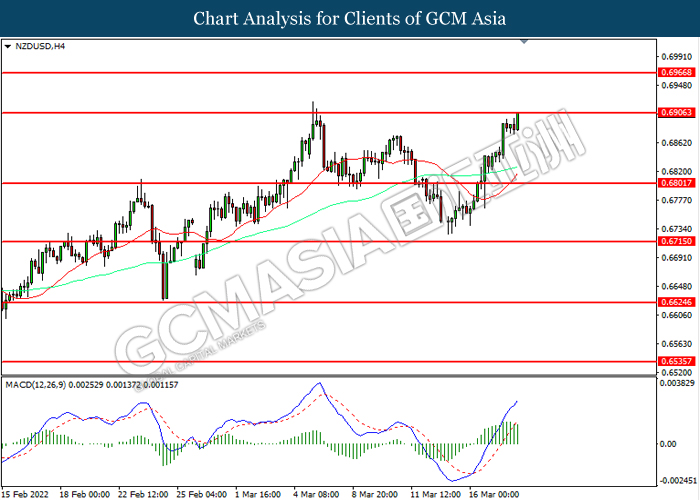

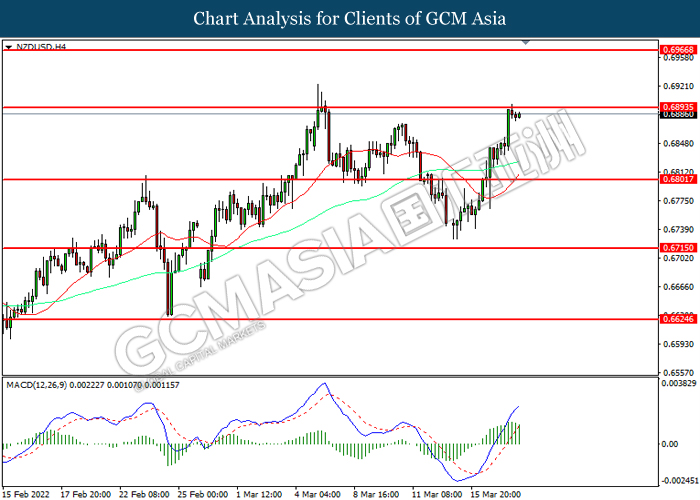

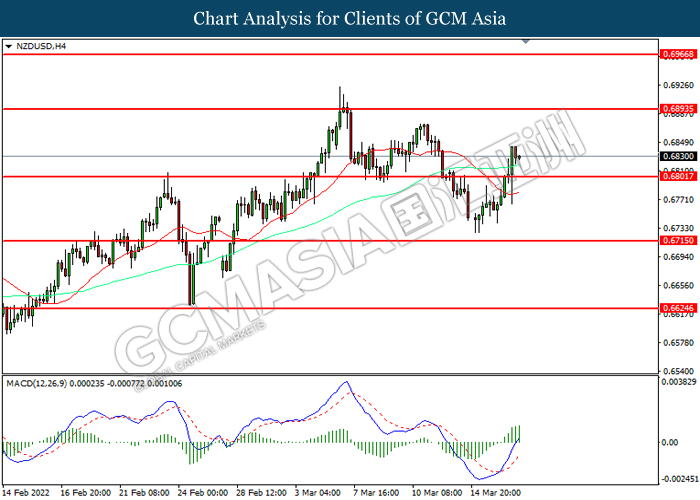

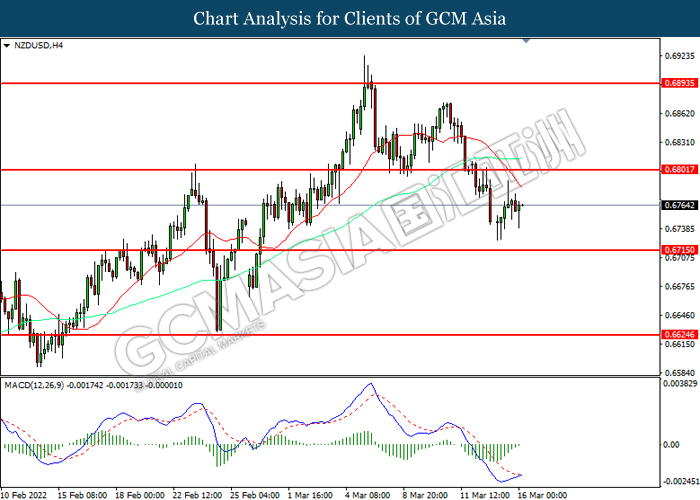

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

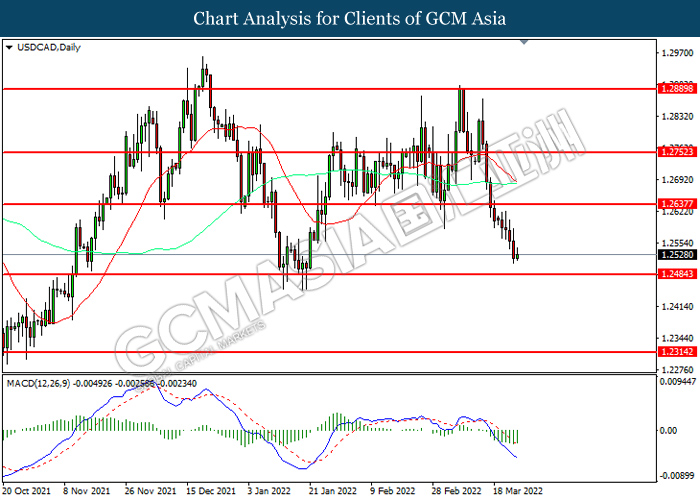

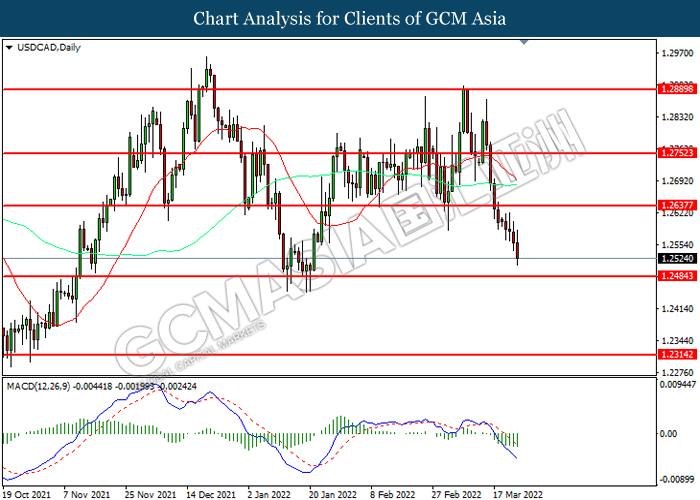

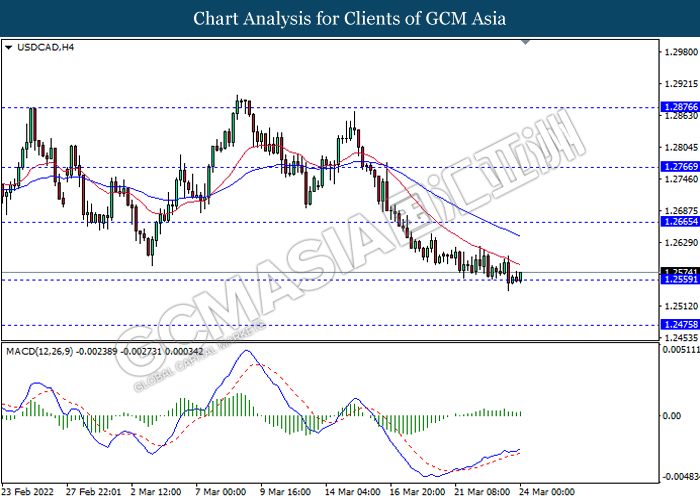

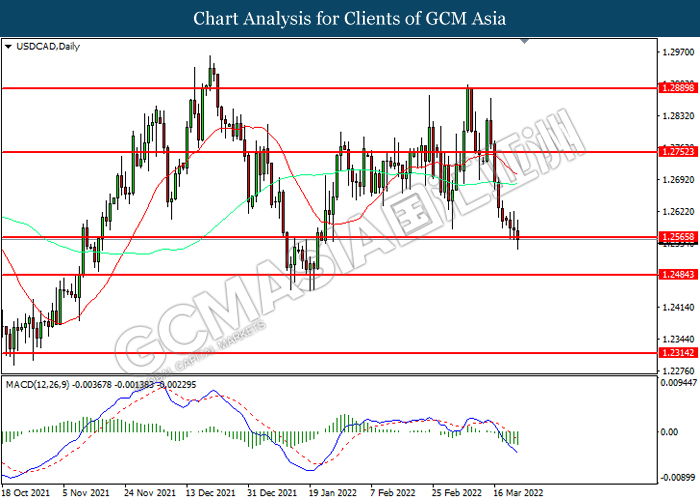

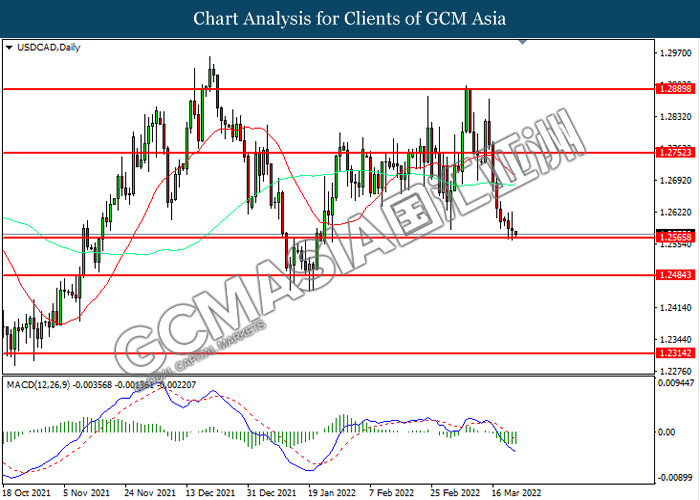

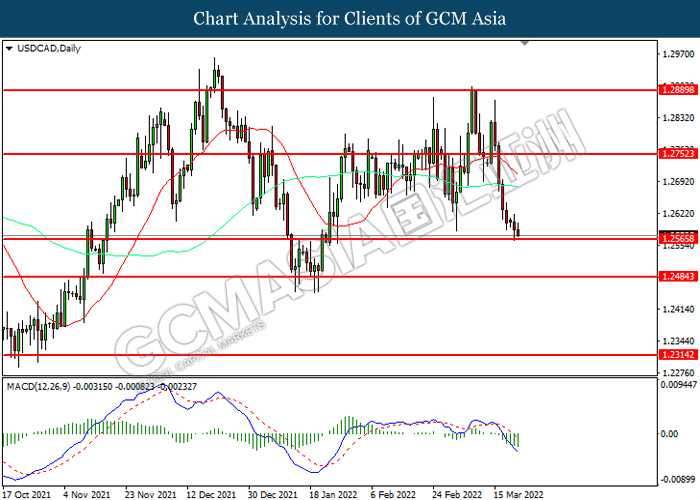

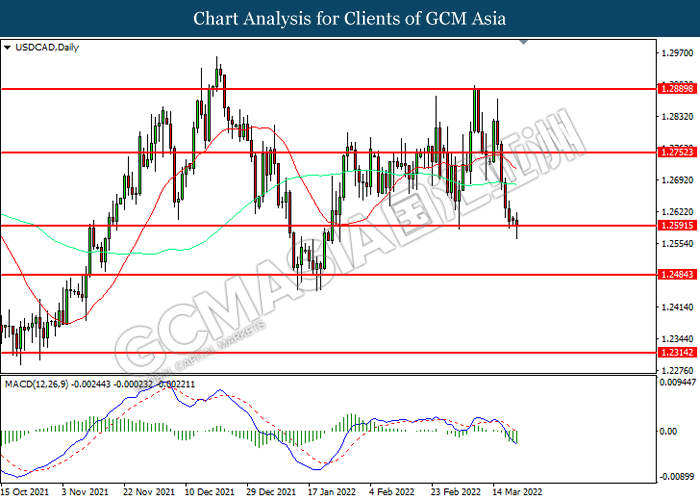

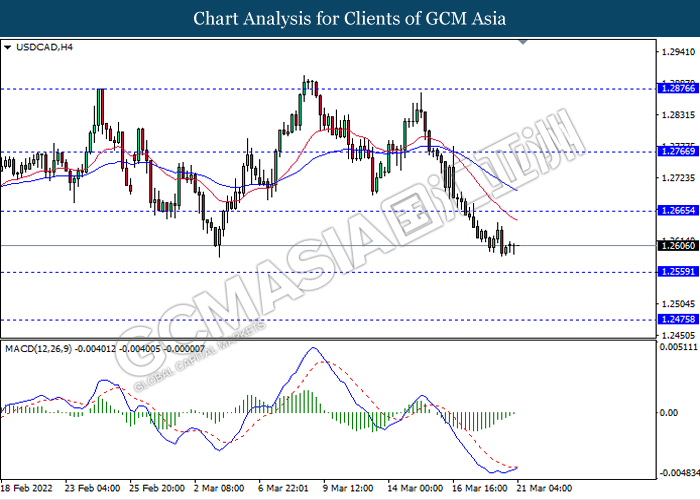

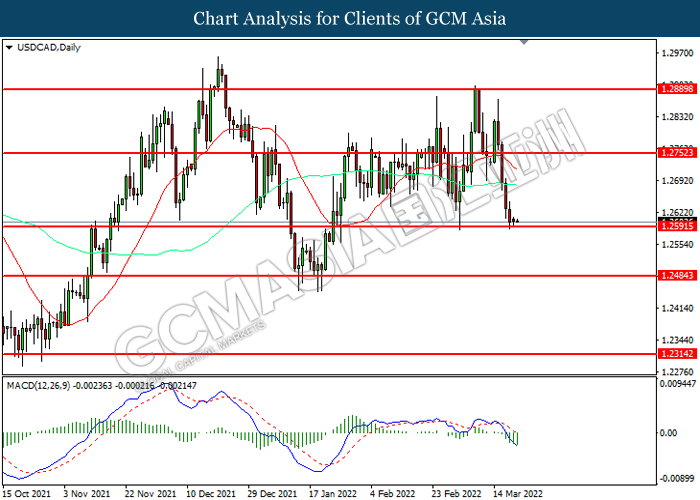

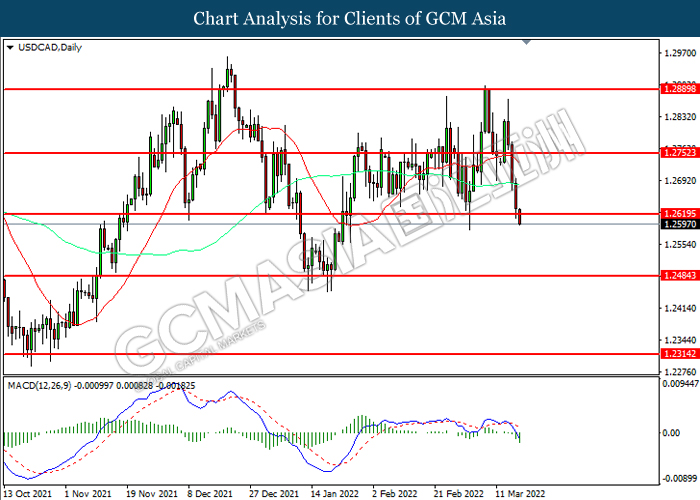

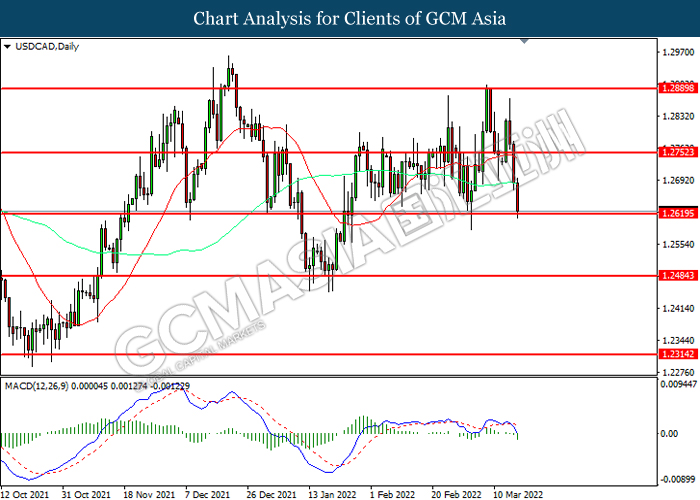

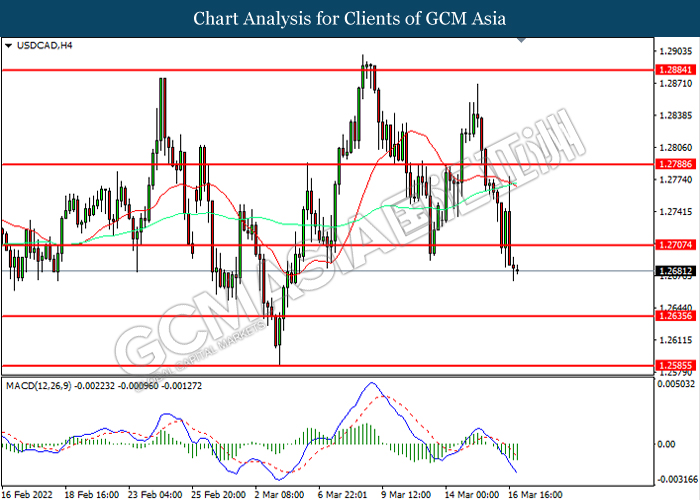

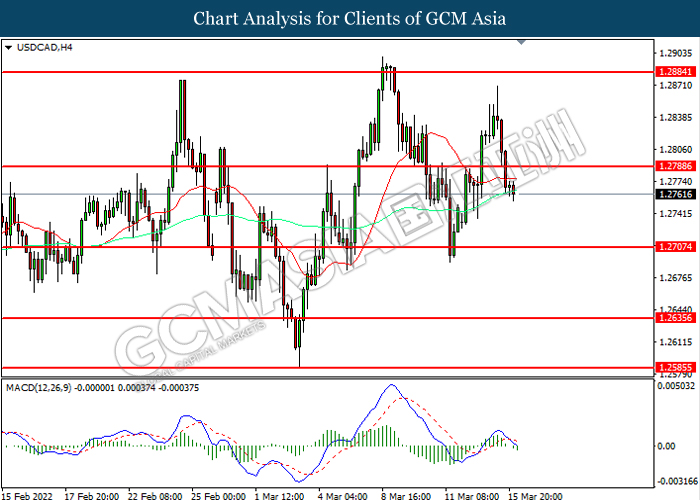

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

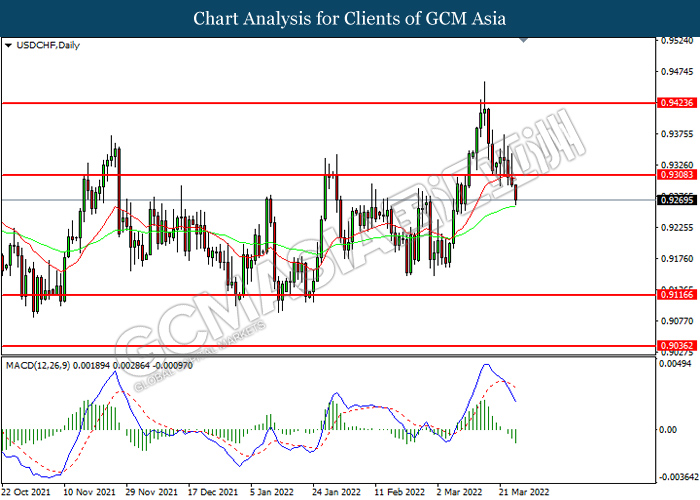

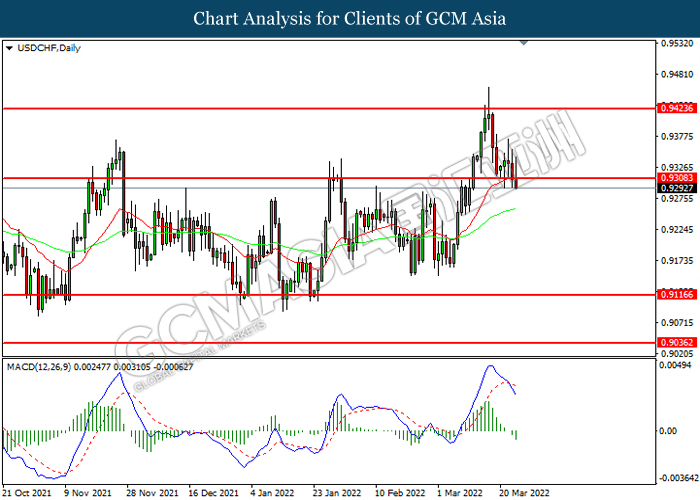

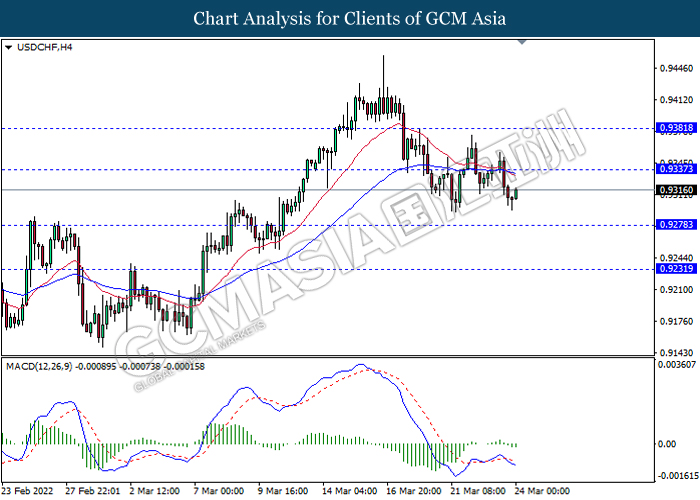

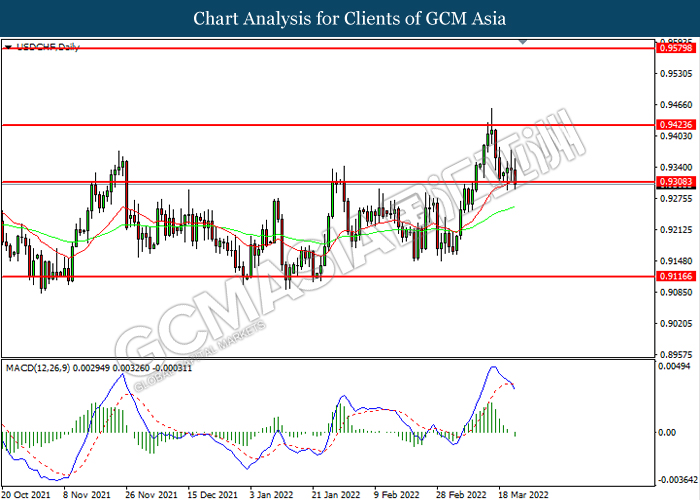

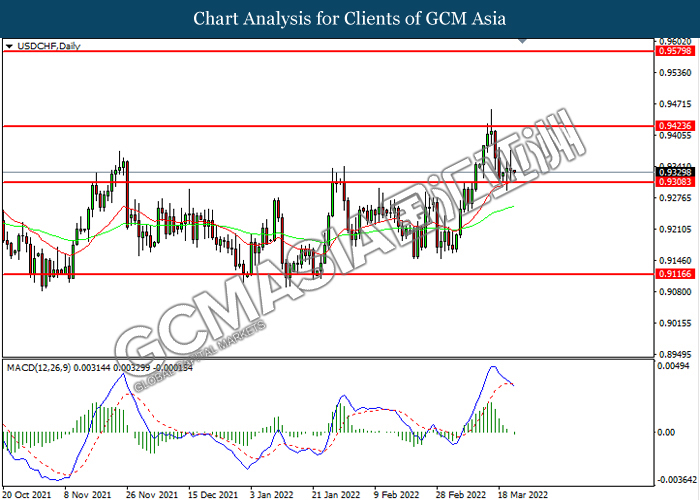

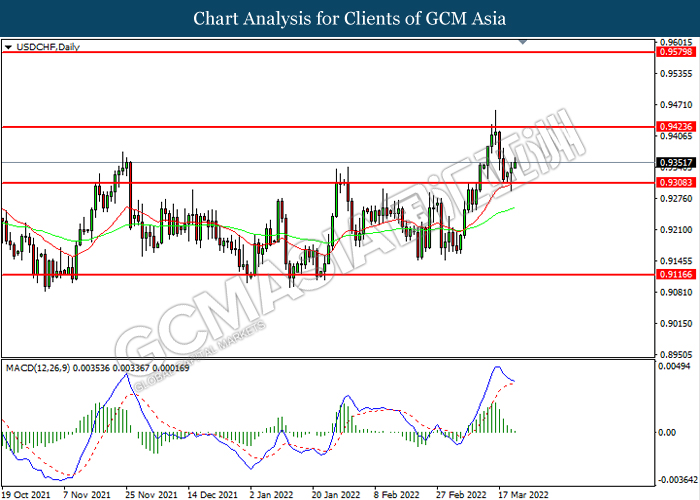

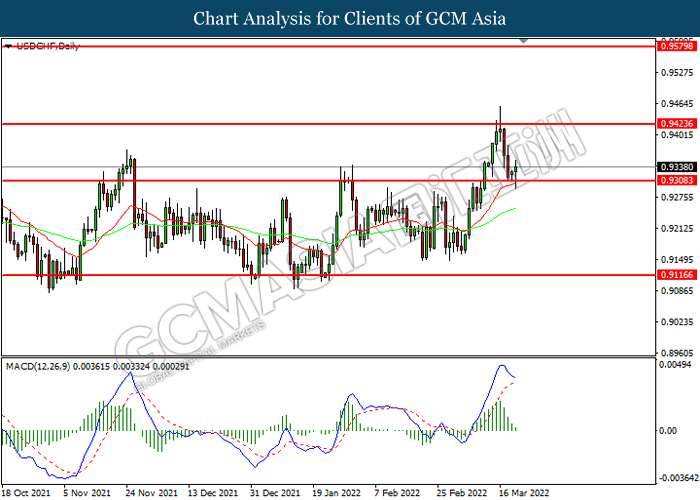

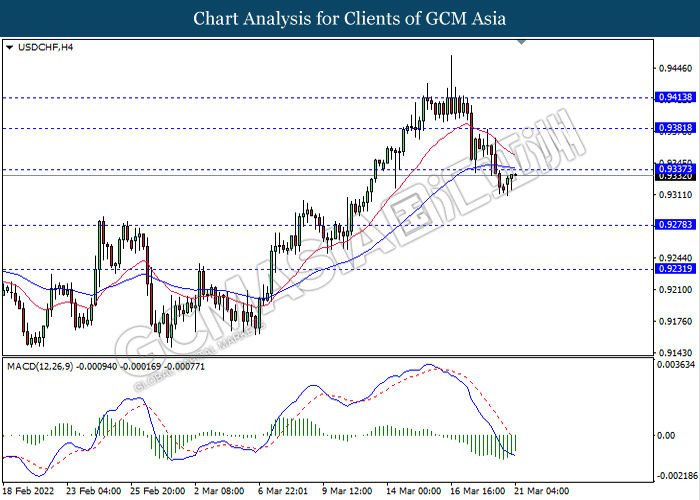

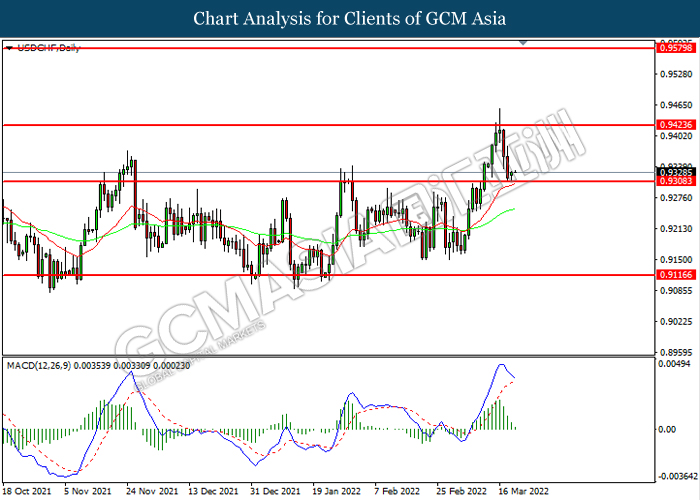

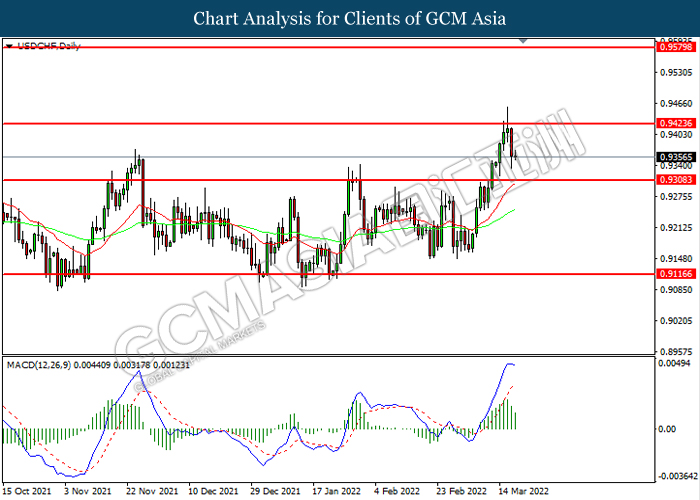

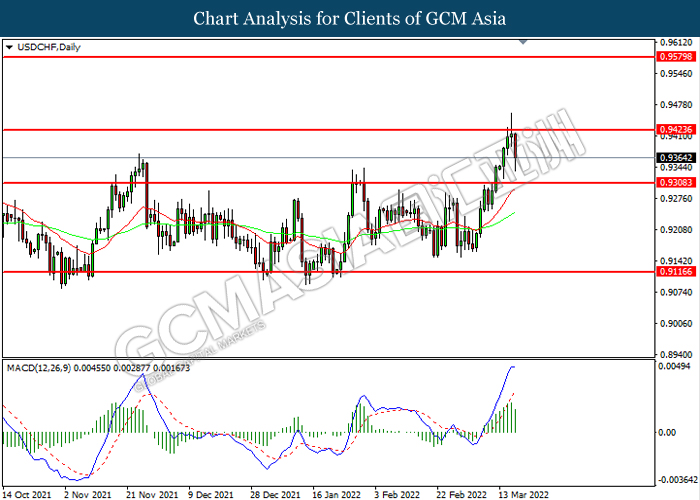

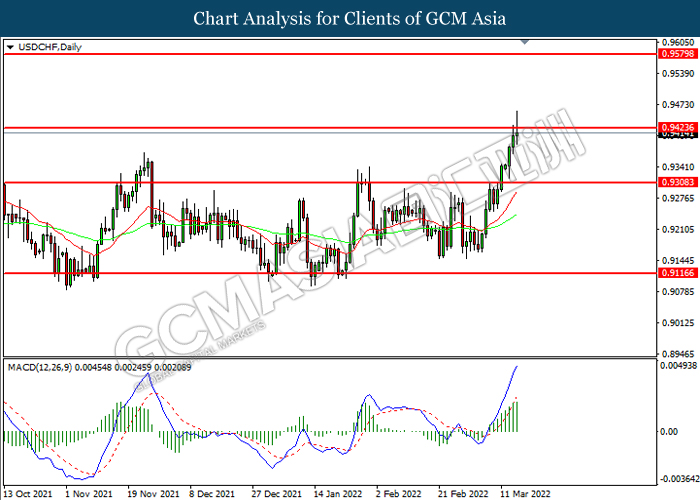

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9310, 0.9425

Support level: 0.9115, 0.9035

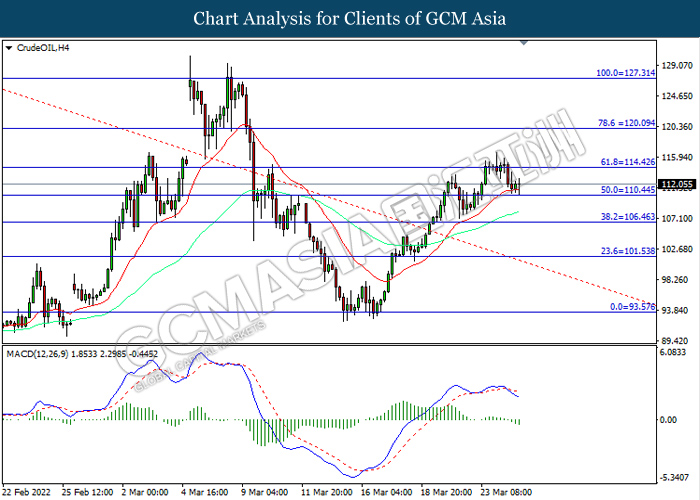

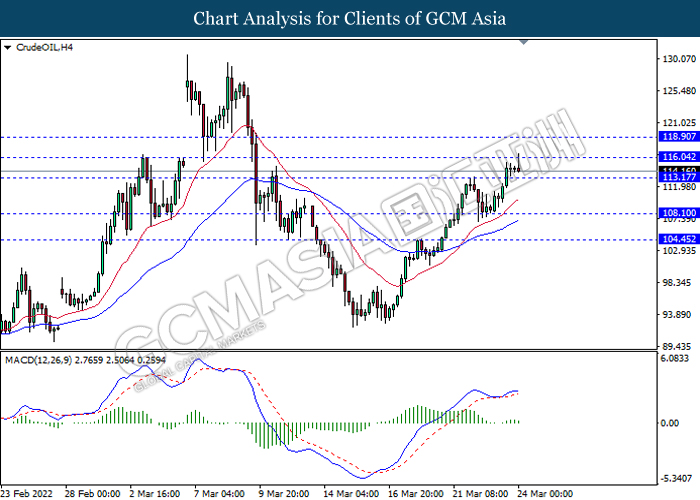

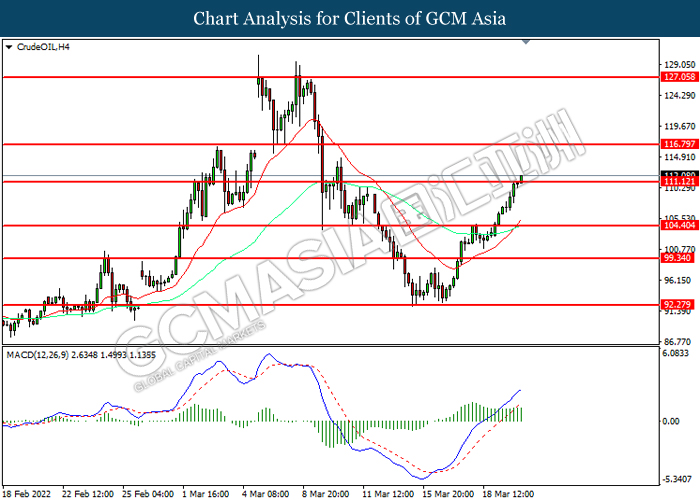

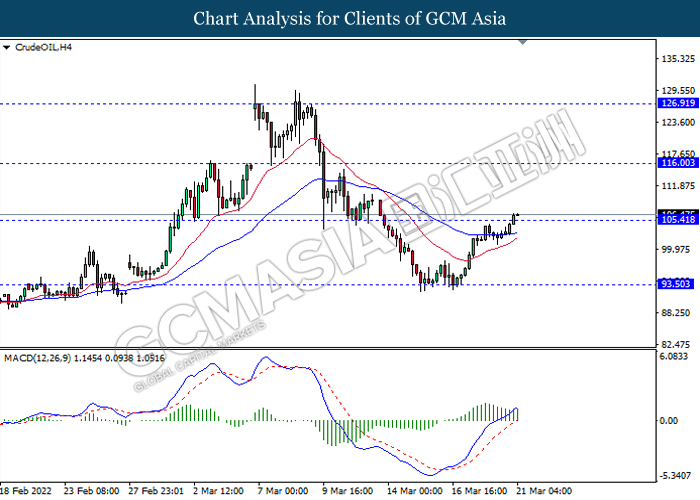

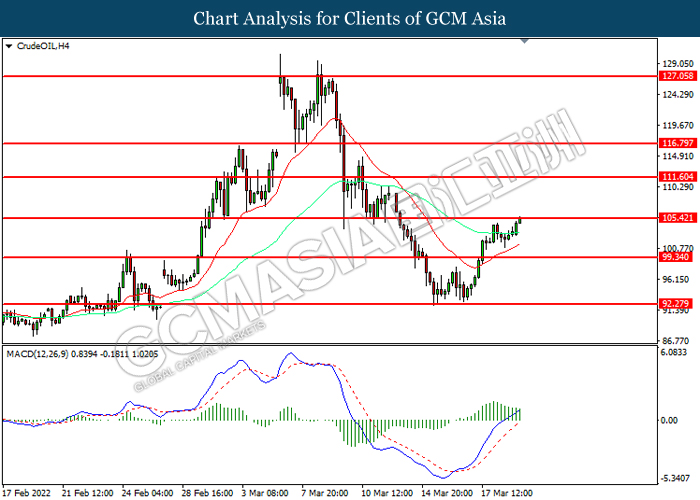

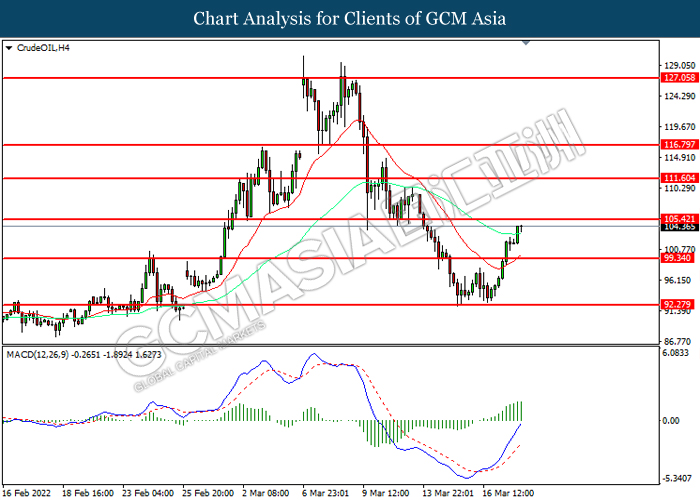

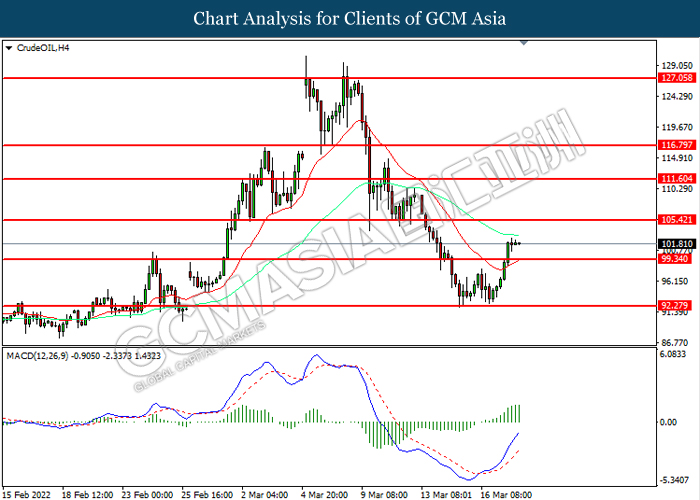

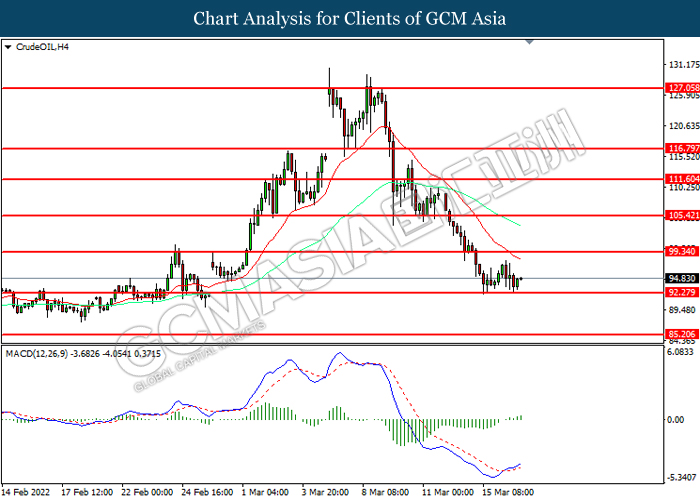

CrudeOIL, H4 : Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 114.45, 120.10

Support level: 110.45, 106.45

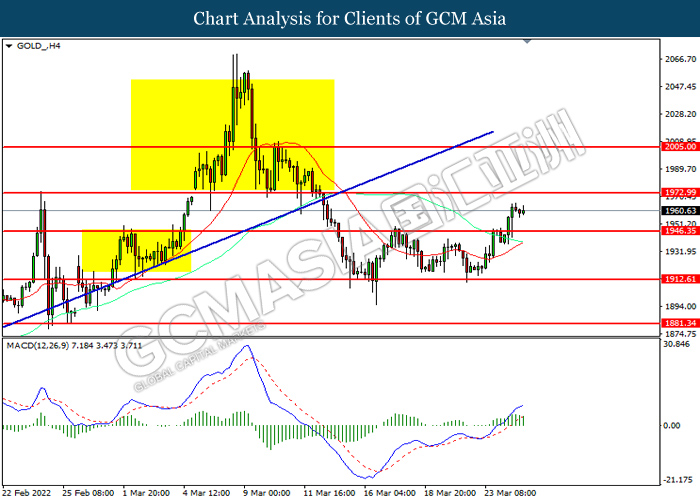

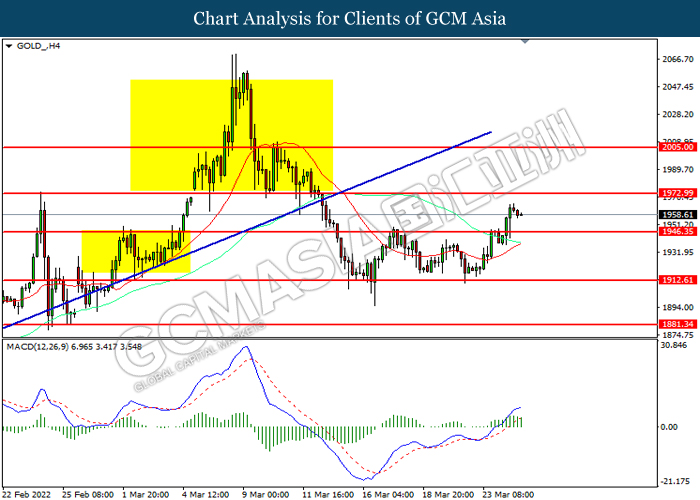

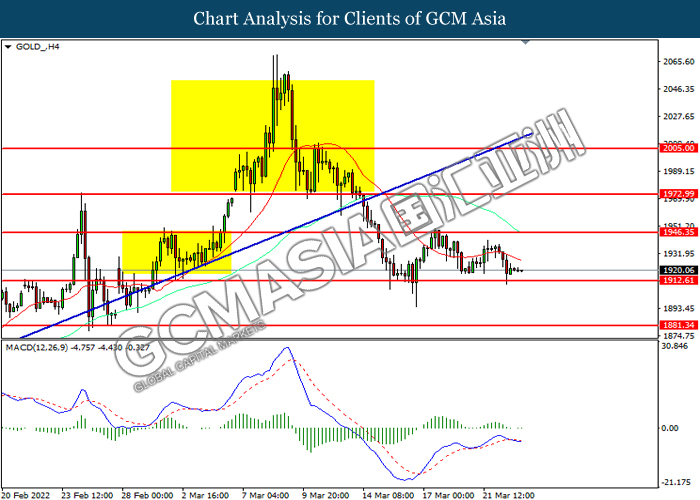

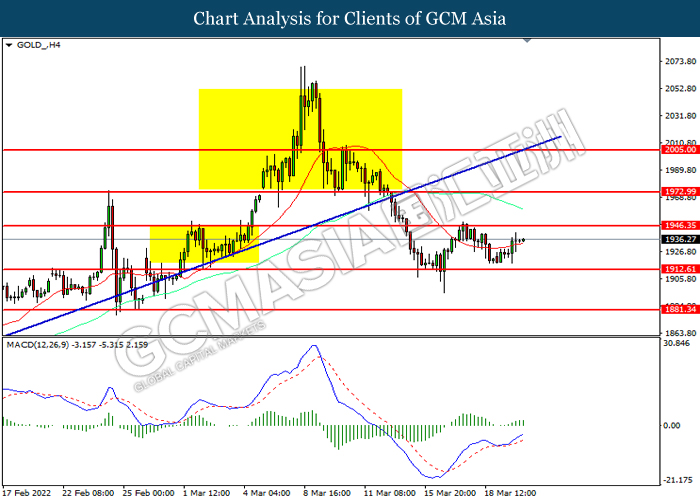

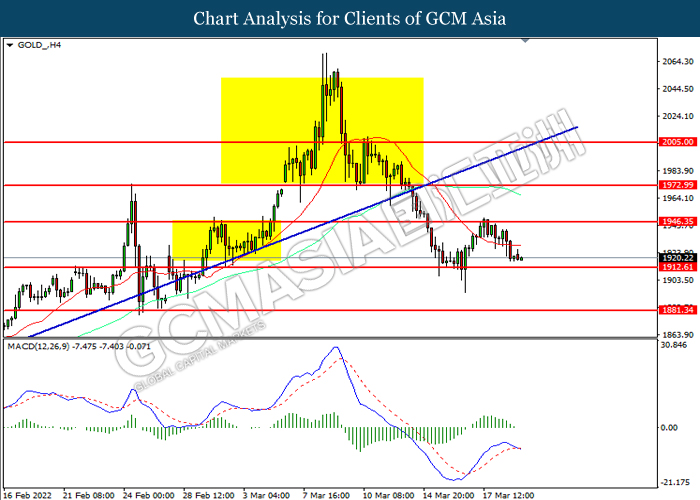

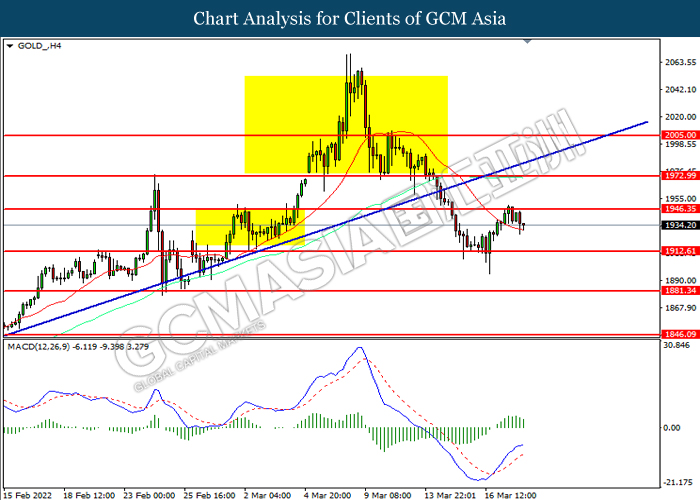

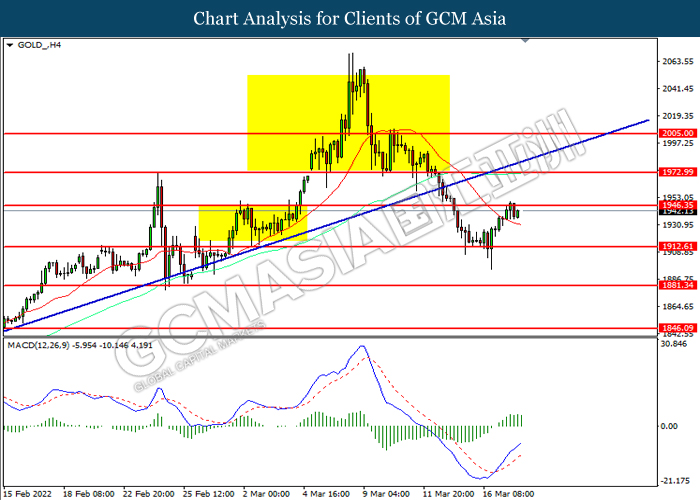

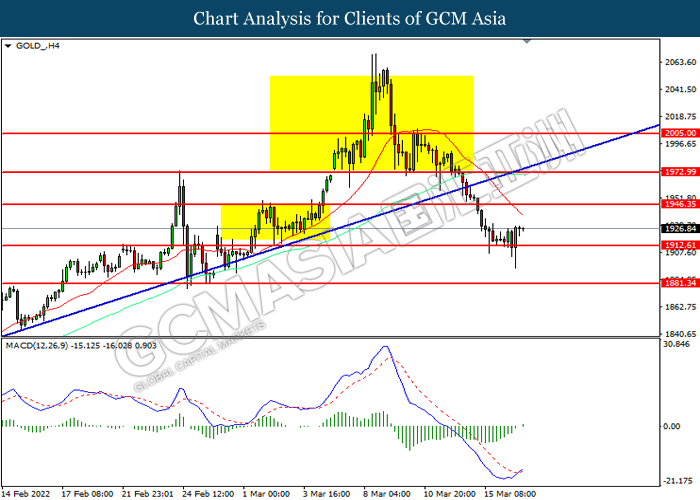

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1946.35, 1912.60

250322 Morning Session Analysis

25 March 2022 Morning Session Analysis

US Dollar appreciated on upbeat data and hawk expectation.

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of upbeat economic data from the United States yesterday. According to Department of Labor, US Initial Jobless Claims notched down significantly from the preliminary reading of 215K to 187K, better than the market forecast at 212K, the lowest level since September 1969. Though, the US Durable Goods Orders unexpectedly declined in February as delayed shipment as well as supply shortage issues. The positive economic data and the hawkish statement from Federal Reserve have strengthened hopes upon the central bank to implement a more aggressive contractionary monetary policy. Expectations for a hike of 50 basis point during the May meeting are currently priced at 70.5%, according to CME’s FedWatch tool. As of writing, the Dollar Index appreciated by 0.15% to 98.75.

In the commodities market, the crude oil price depreciated by 0.05% to $113.50 per barrel as of writing following the European Unions dropped the proposal of banning Russian supply. On the other hand, the gold price appreciated by 0.07% to $1959.20 amid risk-off sentiment in the global financial market following the rising tensions between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Feb) | 1.90% | 0.80% | – |

| 17:00 | EUR – German Ifo Business Climate Index (Mar) | 98.9 | 94 | – |

| 22:00 | USD – Pending Home Sales (MoM) (Feb) | -5.70% | 1.50% | – |

Technical Analysis

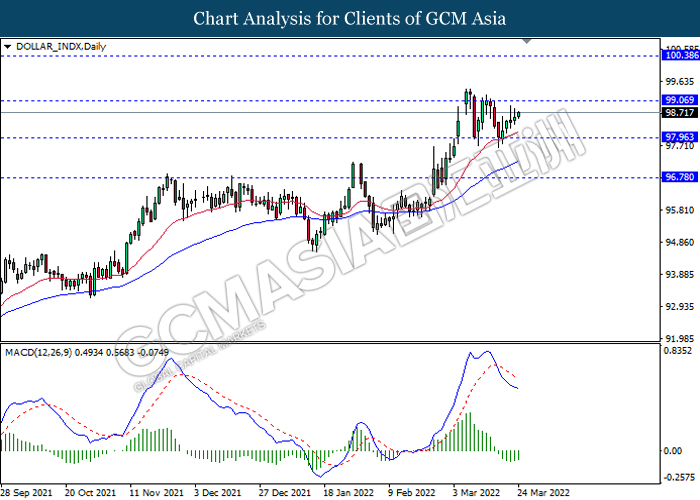

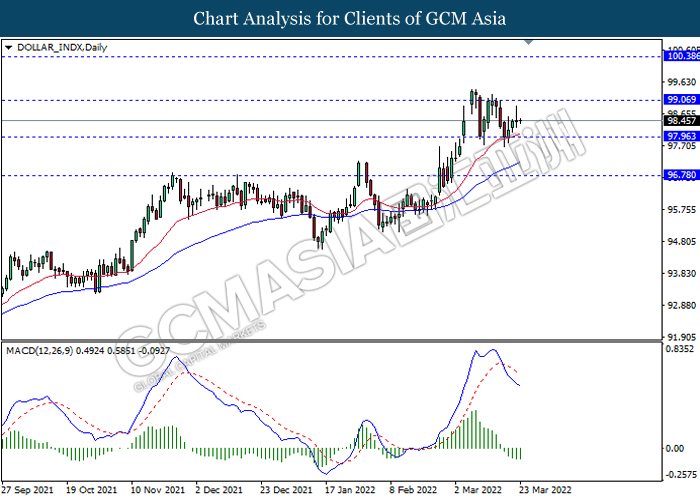

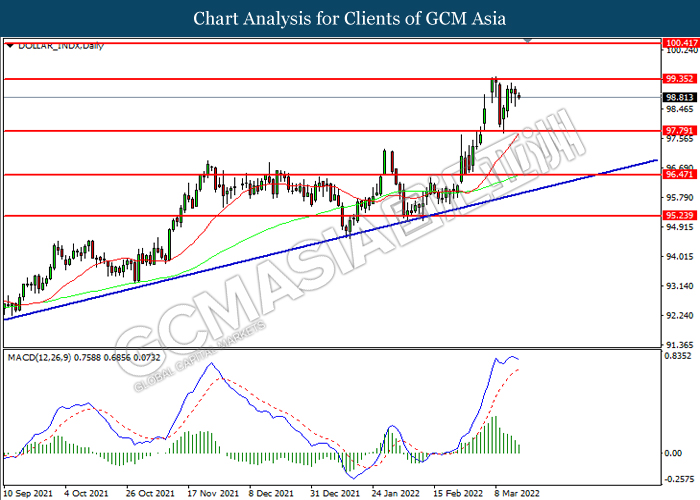

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

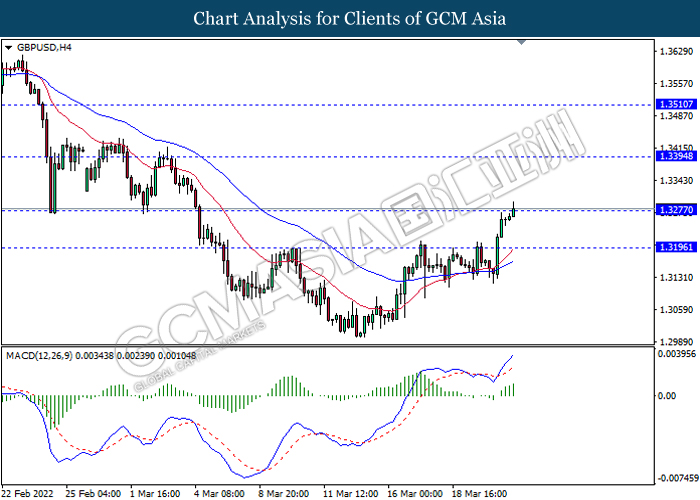

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3285, 1.3420

Support level: 1.3195, 1.3125

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9310, 0.9425

Support level: 0.9115, 0.9035

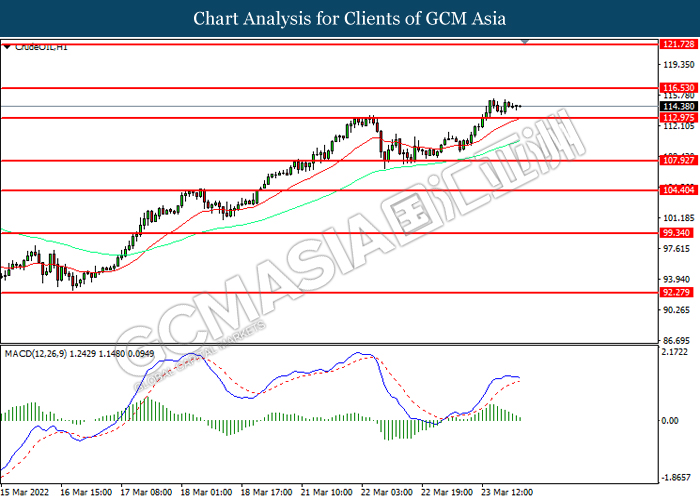

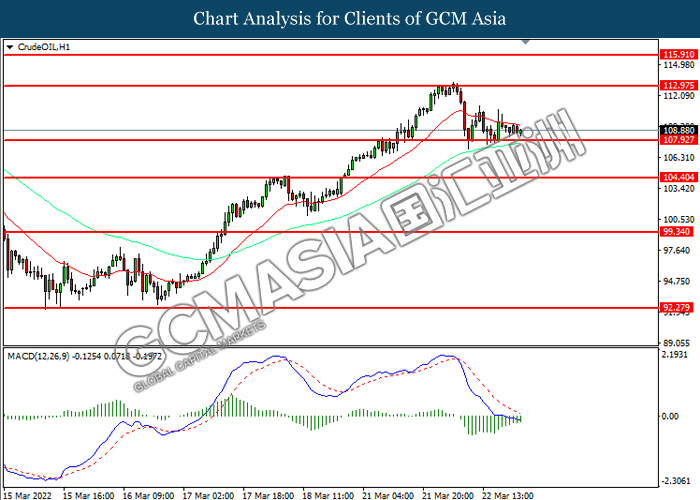

CrudeOIL, H1: Crude oil price was traded lower following prior breakout below the previous support level at 112.95. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 112.95, 116.55

Support level: 107.95, 104.40

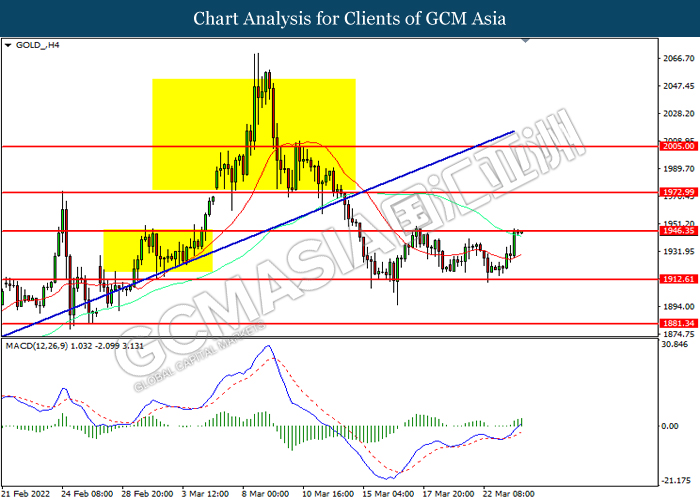

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1946.35, 1912.60

240322 Afternoon Session Analysis

24 March 2022 Afternoon Session Analysis

Pound Sterling slumped amid negative economic prosect.

The Pound Sterling slumped over the backdrop of negative economic prospect as the announcement of fiscal policy from UK Chancellor Rishi Sunak’s failed to impress investors. Yesterday, Chancellor Rishi Sunak had announced the implementation of a fuel duty tax cut, a lift to the tax-free earnings threshold, a slight reduction to the tax rate for the bottom bracket and new support for businesses. Investors speculated that such new policies would not do much to improve the weak outlook for the UK economy as the high inflation risk continue to hover in in the market. According the Office for National Statistics, UK Consumer Price Index (CPI) notched up significantly from the previous reading of 5.5% to 6.2%, exceeding the market forecast at 5.9%. Besides, the rising tensions between Russia-Ukraine ahead of the meeting for the Western leaders had also diminished further risk appetite in the global financial market, dragging down the appeal for the risker asset such as Pound Sterling. As of writing, GBP/USD depreciated by 0.08% to 1.3192.

In the commodities market, the crude oil price depreciated by 0.55% to $115.65 per barrel as of writing mostly due to technical correction. Investors would continue to remain their focus toward US-EU meeting today to receive further trading signal. On the other hand, the gold price appreciated by 0.03% to $1940.45 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | -0.75% | -0.75% | – |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 58.4 | 56 | – |

| 17:30 | GBP – Composite PMI | 59.9 | 58.7 | – |

| 17:30 | GBP – Manufacturing PMI | 58 | 57 | – |

| 17:30 | GBP – Services PMI | 60.5 | 58 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.70% | 0.60% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 211K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 99.05, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1110, 1.1230

Support level: 1.0950, 1.0845

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.25, 125.15

Support level: 120.60, 118.20

AUDUSD, Daily: AUDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7545, 0.7660

Support level: 0.7460, 0.7365

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2665, 1.2765

Support level: 1.2560, 1.2475

USDCHF, H4: USDCHF was traded lower following prior breakout the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9335, 0.9380

Support level: 0.9280, 0.9230

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 116.05, 118.90

Support level: 113.15, 108.10

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1961.55, 1980.75

Support level: 1940.95, 1924.20

240322 Morning Session Analysis

24 March 2022 Morning Session Analysis

US Dollar surged ahead of the sanction’s announcement.

The Dollar Index which traded against a basket of six major currencies surged over the backdrop of diminishing risk appetite in the global financial market ahead of the meeting between United States, NATO and European leaders. As for now, market participants would continue to scrutinize the latest updates with regards of the meeting in order to receive further trading signal. The meeting for the Western countries would likely to announce new sanctions against Russia. The price for commodities product such as crude oil and wheat have risen as tensions in Ukraine have escalated, spurring additional pressure on high inflation rate due to supply chain disruption recently. Spiking numbers of inflation rate has led many central banks, including US Federal Reserve to implement contractionary monetary policy, spurring further bullish momentum for the US Dollar in longer-term basis. As of writing, the Dollar Index appreciated by 0.12% to 98.61.

In the commodities market, the crude oil price surged 0.04% to 116.35 per barrel as of writing following the released of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -2.508M, better than the market forecast at 0.114M. On the other hand, the gold price appreciated by 0.11% to $1946.50 per troy ounces as of writing amid risk-off sentiment in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | -0.75% | -0.75% | – |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 58.4 | 56 | – |

| 17:30 | GBP – Composite PMI | 59.9 | 58.7 | – |

| 17:30 | GBP – Manufacturing PMI | 58 | 57 | – |

| 17:30 | GBP – Services PMI | 60.5 | 58 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.70% | 0.60% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 211K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3300, 1.3420

Support level: 1.3195, 1.3125

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2565, 1.2485

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it breakout.

Resistance level: 116.55, 121.75

Support level: 112.95, 107.95

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

230322 Afternoon Session Analysis

23 March 2022 Afternoon Session Analysis

Pound surged amid hopes upon hike rate.

Pound started rebounding on Tuesday following sparking hopes of Bank of England rate hike upon inflation risk. According to Reuters, the Pound could mount a further recovery against US Dollar on Wednesday, and is poised for wild swings as data showing inflation remains red-hot could renew bets on Bank of England rate hikes. Commerzbank also appeared a speak that Bank of England would likely to hike rates by 50 basis points in March, but it signaled a modest tightening of interest rates over the coming months. The spike of commodities price such as crude oil would causing the import cost of companies to soar, indirectly leading to the hike inflation. The implementation of tightening monetary policy would likely to diminish money circulation in England market and leading to appreciation of Pound. It dialed up the market optimism on Pound and prompting investors to purchase Pound, spurring further bullish momentum on the pair. Investors should continue to scrutinize the latest updates with regards of Bank of England upon hike rate decision to gauge the likelihood movement of Pound. As of writing, GBPUSD appreciated by 0.18% to 1.3287.

In commodities market, crude oil price appreciated by 1.60% to $111.00 per barrel as of writing over the backdrop of EU considering to ban Russian oil. Besides, gold appreciated by 0.15% to $1924.40 per troy ounces as of writing as the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Gov Bailey Speaks

20:00 USD Fed Chair Powell Speaks

20:30 GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Feb) | 5.50% | 5.90% | – |

| 22:00 | USD – New Home Sales (Feb) | 801K | 813K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.345M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 99.05, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3395, 1.3510

Support level: 1.3275, 1.3195

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.1110, 1.1230

Support level: 1.0950, 1.0845

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.25, 125.15

Support level: 120.60, 118.20

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7460, 0.7545

Support level: 0.7365, 0.7260

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2665, 1.2765

Support level: 1.2560, 1.2475

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9335, 0.9380

Support level: 0.9280, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 113.15, 116.05

Support level: 108.10, 104.45

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1924.20, 1940.95

Support level: 1904.80, 1887.95

230322 Morning Session Analysis

23 March 2022 Morning Session Analysis

US Dollar slumped as risk-on sentiment lingered in market.

The Dollar Index which traded against a basket of six major currencies retreated from its higher level as profit taking following market participants had digested the hawkish tone from US Federal Reserve Chair Jerome Powell. In fact, the rise in US equities market had also insinuated risk-on sentiment in the global financial market, which prompting investors to shift their portfolio toward riskier asset such as Pound Sterling. The banking sector in United States rebounded significantly as investors speculated the rate hike expectation from Fed as well as the economic recovery would likely to enhance the prospect for the banking sector. Besides, the retracement of oil price yesterday had sparked positive prospect toward the economic momentum in future, which spurring further bearish momentum on the safe-haven US Dollar. As of writing, the Dollar Index depreciated by 0.08% to 98.42.

In the commodities market, the crude oil price depreciated by 0.04% to $110.75 per barrel as of writing following the European Union’s foreign ministers unable to reach consensus with regards of whether to impose sanctions on Russia’s energy sector over its invasion of Ukraine. On the other hand, the gold price slumped 0.01% to $1921.40 pre troy ounces as of writing amid risk-on sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Gov Bailey Speaks

20:00 USD Fed Chair Powell Speaks

20:30 GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Feb) | 5.50% | 5.90% | – |

| 22:00 | USD – New Home Sales (Feb) | 801K | 813K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.345M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3300, 1.3420

Support level: 1.3195, 1.3125

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2565, 1.2485

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 112.95, 115.90

Support level: 107.95, 104.40

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

220322 Afternoon Session Analysis

22 March 2022 Afternoon Session Analysis

Euro beaten down following the surge of oil price.

The Euro extend its losses on Tuesday following of European Union to mull Russian oil embargo. According to Reuters, European Union governments will consider whether to impose an oil ban on Russia over its invasion of Ukraine as they gather this week with U.S. President Joe Biden for a series of summits designed to harden the West’s response to Moscow. Besides, the EU and allies have already imposed a panoply of measures against Russia, including freezing its central bank’s assets. Banning Russian oil would likely to diminish the oil circulation in the market, leading to the spike of crude oil price. Nonetheless, as EU mainly depends on Russia for imports of energy products, it would dial down the market optimism toward economic progression in Europe if EU ban Russian oil indeed. The surging oil price would also increase the import cost of companies, spurring further bearish momentum on the pair. Investors should continue to scrutinize the latest updates with regards of EU decision upon oil embargo on Russia to receive further trading signals. As of writing, Euro depreciated by 0.13% to 1.1000.

In commodities market, crude oil price appreciated by 2.53% to $112.75 per barrel as of writing over the backdrop of EU to mull Russian oil embargo. Besides, gold appreciated by 0.35% to $1936.30 per troy ounces as of writing under rising tensions of Russian-Ukraine conflict.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

EURUSD, H4: EURUSD was traded lower while currently testing support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 119.90, 122.95

Support level: 116.15, 113.45

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2755, 1.2890

Support level: 1.2565, 1.2485

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 115.90, 121.75

Support level: 111.10, 104.40

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

220322 Morning Session Analysis

22 March 2022 Morning Session Analysis

Rising US Treasury yield, spurring bullish momentum on US Dollar.

The Dollar Index which traded against a basket of six major currencies extend its gains following Federal Reserve Chair Jerome Powell unleashed his hawkish tone yesterday, sparking bets of more aggressive interest hikes while prompting investors to shift their portfolio toward US Dollar. Investors are now speculating a 60.7% chance of a 50-basis point rate hike during the next monetary policy meeting at May, notched up from about 52% before Powell’s comments. The US 10-year Treasury yield hit 2.28%, the highest since the year of 2019. Besides, Federal Reserve Chair Jerome Powell also reiterated that the US central bank must move quicky to stabilize the spiking number of inflation risks, adding that they could use a more aggressive contractionary monetary policy if needed. As of writing, the Dollar Index appreciated by 0.25% to 98.48.

In the commodities market, the crude oil price appreciated by 0.40% to 113.42 per barrel as of writing amid major European nations considered joining the United States to impose sanction on Russian oil, spurring fears upon the further oil supply disruption in future. On the other hand, the gold price slumped 0.03% to $1935.25 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. However, MACD which illustrated increasing bearish suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 119.90, 122.95

Support level: 116.15, 113.45

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2590, 1.2485

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 111.10, 116.80

Support level: 104.40, 99.35

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

210322 Afternoon Session Analysis

21 March 2022 Afternoon Session Analysis

Canada Dollar surged following the released retail sales data.

The USDCAD extend its losses on Monday amid the upbeat retail sales data in Canada. According to Statistics Canada, Canada Core Retail Sales (MoM) notched up from the previous reading of -2.7% to 2.5%, exceeding the market forecast of 2.4%. The retail sales index measure the change in total value of sales at retail level, which is taken as an indicator of consumer confident. An upbeat retail sales index data in Canada indicates that Canada residents are willing to spend for consumption, leading market optimism toward economic momentum in Canada region and prompting investors to purchase Canada Dollar. Besides, US Existing Home Sales came in at 6.2M, which lower than the previous reading of 6.49M and the market forecast of 6.10M, according to National Association of Realtors. The housing market in US which lower than expected reading was dialing down the market optimism toward US economic momentum, prompting investors to selloff US Dollar and purchase other currencies such as Canada Dollar, spurring further bearish momentum on USDCAD pairing. Nonetheless, the dump of the pair was limited over the backdrop of hawkish tone from Federal Reserve. As of writing, USDCAD appreciated by 0.06% to 1.2609.

In commodities market, crude oil price extend its gains by 2.92% to $106.10 per barrel as of writing amid the backdrop of European Union is to mull a Russian oil embargo this week. On the other hand, gold price depreciated by 0.10% to $1927.35 per troy ounces as of writing as the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 EUR ECB President Lagarde Speaks

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: The Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 98.90, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded higher while following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3275

Support level: 1.3085, 1.2995

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1140, 1.1290

Support level: 1.0910, 1.0785

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 120.60, 123.25

Support level: 118.20, 116.15

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7460, 0.7545

Support level: 0.7365, 0.7260

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2665, 1.2465

Support level: 1.2560, 1.2475

USDCHF, H4: USDCHF was traded lower while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9335, 0.9380

Support level: 0.9280, 0.9230

CrudeOIL, H4: Crude oil was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 116.00, 126.90

Support level: 105.40, 93.50

GOLD, H4: Gold was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1961.55, 1999.45

Support level: 1924.20, 1886.90

210322 Morning Session Analysis

21 March 2022 Morning Session Analysis

US Dollar surged following Fed unleashed hawkish tone.

The Dollar Index which traded against a basket of six major currencies surged on last Friday over the backdrop of hawkish tone from Federal Reserve. According to Reuters, two of the Federal Reserve policymakers claimed that the central bank needs to take more aggressive steps to tame inflation following its reached 40-year highs. St. Louis Fed president James Bullard claimed that he is in favor of a half-point increase interest, while reiterating that Fed’s overnight lending rate to increase to more than 3% this year. Most of the policymakers had expressed their support for more aggressive action, with seven projecting rates to rise above 2% in year of 2022. Nonetheless, investors would continue to scrutinize the latest updates with regards of further crucial economic data as well monetary policy plan to receive further trading signal. As of writing, the Dollar Index surged 0.26% to 98.25.

In the commodities market, the crude oil price appreciated by 1.20% to $105.45 per barrel as of writing amid rising tension between Russian-Ukraine continue to be spurring bullish momentum on the crude oil price. On the other hand, the gold price depreciated by 1.10% to $1921.30 per troy ounces as of writing amid hawkish expectation from Fed continue to drag down the appeal for inflation-hedging commodity such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 EUR ECB President Lagarde Speaks

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 119.20, 120.50

Support level: 117.50, 116.25

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6895. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2590, 1.2485

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 105.40, 111.60

Support level: 99.35, 92.30

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

180322 Afternoon Session Analysis

18 March 2022 Afternoon Session Analysis

Pound surged over the hawkish tone from BoE.

Pound Sterling surged over the backdrop of hawkish sentiment from the Bank of England. Yesterday, the Bank of England increased interest rates for the third consecutive meeting while reiterating that the Russia-Ukraine conflict is expected to keep inflation higher in long-term basis. The Monetary Policy Committee voted 8-1 in favor of a further 0.25 percentage point hike to its main Bank Rank, taking it to 0.75%. Currently, UK inflation was already running at a 30-year high prior to Russian’s invasion of Ukraine, which sent energy prices surging and spurring further pressure on the central bank’s inflation projections. The Bank now forecasted that the inflation rate could be expected to increase further in the coming months, hitting around 8% in the second quarter of 2022 or even higher. The MPC also claimed that further modest tightening in monetary policy may be appropriate in the coming months. As of writing, GBP/USD appreciated by 0.12% to 1.3163.

In commodities market, gold price appreciated by 0.10% to $1933.95 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

14:30 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core Retail Sales (MoM) (Jan) | -2.50% | -2.00% | – |

| 23:00 | USD – Existing Home Sales (Feb) | 6.50M | 6.16M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6895. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2620, 1.2485

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 99.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 105.40.

Resistance level: 105.40, 111.60

Support level: 99.35, 92.30

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

180322 Morning Session Analysis

18 March 2022 Morning Session Analysis

Euro surged following the released of inflation data.

The Euro surged on yesterday over the backdrop of upbeat inflation data, which increasing the odds for the European Central Bank to be tightening the monetary policy in order to combat such high inflation risk. According to Eurostat, Eurozone Consumer Price Index (CPI) YoY notched up from the previous reading of 5.8% to 5.9% on year in February, exceeding the market forecast. The acceleration in the Eurozone’s annual inflation rate had adds further evidence to a build-up in price pressures globally that is lasting longer than initially expected. High inflation risk would likely to prompt the European Central Bank to implement contractionary monetary policy as well as increase their interest rate, which diminishing the money circulation in the Europe market while spurring bullish momentum on Euro. As of writing, EUR/USD surged 0.05% to 1.1095.

In the commodities market, the crude oil price rebounded 0.15% to $103.85 per barrel as of writing amid the rising tension between Russia-Ukraine had spurred fears upon the oil supply disruption. According to Azjazeera, Ukraine accused Russian forces of bombing a theatre sheltering civilians in the besieged southern city of Mariupol. On the other hand, the gold price appreciated by 0.04% to $1941.95 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

14:30 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core Retail Sales (MoM) (Jan) | -2.50% | -2.00% | – |

| 23:00 | USD – Existing Home Sales (Feb) | 6.50M | 6.16M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, Daily: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6895. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 0.6895, 0.6965

Support level: 0.6800, 0.6715

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2620, 1.2485

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 99.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 105.40.

Resistance level: 105.40, 111.60

Support level: 99.35, 92.30

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

170322 Afternoon Session Analysis

17 March 2022 Afternoon Session Analysis

Aussie surged following China unleashed upbeat tone.

Australian Dollar started rebounding since Wednesday amid the backdrop of implementing policies favourable for capital markets in China. Yesterday, Vice Premier in China, Liu He appeared a speak that China will roll out policy steps favourable for its capital markets while cautiously unveiling measures that risk hurting markets in order to maintain market stability, according to The Edge Market. Besides, Liu reiterate the government will also promote the steady and healthy development of the platform economy and will steadily push forward and complete rectifications of big platform firms as soon as possible. China will take measures to boost the economy in the first quarter and monetary policy should embark on initiatives to support the economy. As China is the largest economic partner with Australia, it sparked positive prospects toward economic momentum in Australia as China government intentionally boost up its economic, prompting investors to stoke a shift sentiment toward Australian Dollar. On the other hand, negotiation between Russia and Ukraine had yielded some positive progress, leading to the market optimism toward risk-appetite assets, spurring further upward momentum on the pair. As of writing, Australian dollar appreciated by 0.35% to 0.7315.

In commodities market, crude oil price appreciated by 1.33% to $96.30 per barrel as of writing. Nonetheless, according to Energy Information Administration, US Crude Oil Inventories notched up from the previous reading of -1.863M to 4.345M, exceeding market forecast of -1.375M, indicating the additional supply of oil and putting pressure on oil price. Besides, gold price appreciated by 1.57% to $1939.25 per troy ounces as of writing amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | EUR – ECB President Lagarde Speaks | – | – | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.80% | 5.80% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 0.50% | 0.75% | – |

| 21:30 | USD – Building Permits (Feb) | 1.895M | 1.850M | – |

| 21:30 | USD – Initial Jobless Claims | 227K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | 16 | 15 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, Daily: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6895, 0.6965

Support level: 0.6800, 0.6715

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2705, 1.2790

Support level: 1.2635, 1.2585

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 85.20

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

170322 Morning Session Analysis

17 March 2022 Morning Session Analysis

US Dollar retreated following FOMC statement.

The Dollar Index which traded against a basket of six major currencies retreated following US Federal Reserve unleashed their monetary policy plan without delivering a tougher surprise. According to Reuters, the Federal Reserve on Wednesday had increased their interest rates for the first time since 2018 and laid out an aggressive plan to reduce the bond buying program. The Fed raised interest rates by the expected quarter of a percentage point into 0.5% and forecast the policy rate would reach a range of 1.75% to 2% by the end of this year and 2.8% next year in order to combat the high inflation rate. Besides, the safe-haven US Dollar extend its losses over the backdrop of upbeat sentiment Russia-Ukraine, which prompting investors to shift their portfolio toward other riskier assets. According to the Guardian, currently Russia and Ukraine had indicated that discussion between both sides had yielded some positive progress. As of writing, the Dollar Index depreciated by 0.70% to 98.40.

In the commodities market, the crude oil price depreciated by 0.05% to $96.80 per barrel as of writing. The oil market edged lower amid positive development upon the Russia-Ukraine war had diminished the concerns of supply disruption. On the other hand, the gold price slumped 0.02% to $1926.40 per troy ounces as of writing amid risk-on sentiment in the global market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | EUR – ECB President Lagarde Speaks | – | – | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.80% | 5.80% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 0.50% | 0.75% | – |

| 21:30 | USD – Building Permits (Feb) | 1.895M | 1.850M | – |

| 21:30 | USD – Initial Jobless Claims | 227K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | 16 | 15 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, Daily: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6895, 0.6965

Support level: 0.6800, 0.6715

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2705, 1.2790

Support level: 1.2635, 1.2585

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 85.20

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

160322 Afternoon Session Analysis

16 March 2022 Afternoon Session Analysis

Pound rebounded amid upbeat job data.

British Pound started rebounding since its recent low. According to Office for National Statistics, UK Average Earning Index +Bonus notched up significantly from the previous reading of 4.6% to 4.8%, exceeding the market forecast at 4.6%. UK Claimed Count Change came in at the reading of -48.1k, exceeding the market forecast at -28k and the previous -67.3k. A strong jobs report supported the prospect of a Bank of England rate hike for this month’s meeting while diminishing money supply in UK market. The UK’s Unemployment Rate fell more than expected to 3.9% in the three months to January, while vacancies hit a record high in the three months to February. Meanwhile, money markets continue to fully price in a 25 basis points BoE interest rate hike on Thursday. Both jobs data sparked positive prospects upon UK labor market, dialing up the market optimism toward economic momentum in UK region and spurring bullish momentum on Pound. As of writing, British Pound appreciated by 0.10% to 1.3051.

In commodities market, the crude oil price appreciated by 0.66% to $97.08 per barrel as of writing. Nonetheless, the overall trend of oil price remained downward amid the backdrop of oil supply additions from OPEC+. Besides, gold price depreciated by 0.44% to $1921.30 per troy ounces as of writing as the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Retail Sales (MoM) (Feb) | 3.30% | 1.00% | – |

| 21:30 | USD – Retail Sales (MoM) (Feb) | 3.80% | 0.40% | – |

| 21:30 | CAD – Core CPI (MoM) (Feb) | 0.80% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.863M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded within a range while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7250, 0.7410

Support level: 0.7180, 0.7095

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6800, 0.6895

Support level: 0.6715, 0.6625

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2790, 1.2885

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 85.20

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35