160322 Morning Session Analysis

16 March 2022 Morning Session Analysis

Dollar remained firm ahead of crucial Fed meeting.

The Dollar Index which traded against a basket of six major currencies surged ahead of crucial FOMC meeting this week as investors speculated the Federal Reserve have higher odds to implement contractionary monetary policy in future. Though, as for now investors would continue to remain their focus toward monetary policy decision as well as their statement to receive further trading signal. The US Producer Prices Index rose more moderately in February, keeping the Federal Reserve on track to raise interest rates this week. According to Bureau of Labor Statistics, the Producer Price Index rose significantly last month compared with February last year, the fastest year-on-year rate since 2010. Earlier, the Chair of Federal Reserve Jerome Powell has left open the option of the Fed lifting interest rates by larger increment later on this year. As for writing, the Dollar Index appreciated by 0.02% to 99.00.

In the commodities market, the crude oil price slumped 0.04% to 94.20 per barrel as of writing over the backdrop of bearish inventory data. According to American Petroleum Institute, US API Weekly Crude Oil Stock came in at 3.754M, higher than the market forecast at -1.867M. On the other hand, the gold price depreciated by 0.02% to $1917.50 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Retail Sales (MoM) (Feb) | 3.30% | 1.00% | – |

| 21:30 | USD – Retail Sales (MoM) (Feb) | 3.80% | 0.40% | – |

| 21:30 | CAD – Core CPI (MoM) (Feb) | 0.80% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.863M | – | – |

Technical Analysis

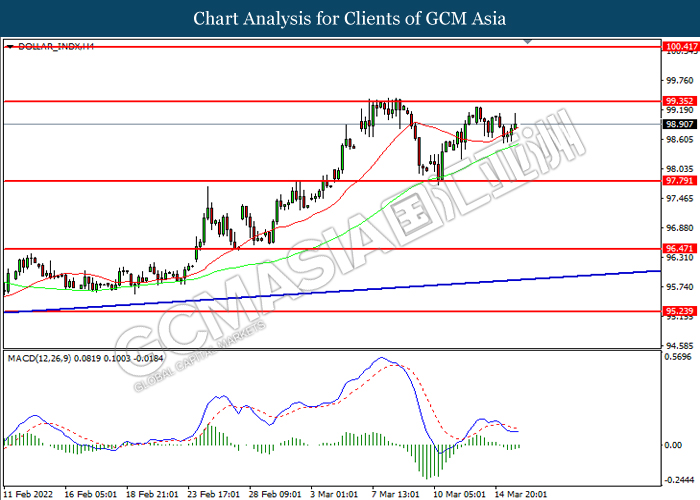

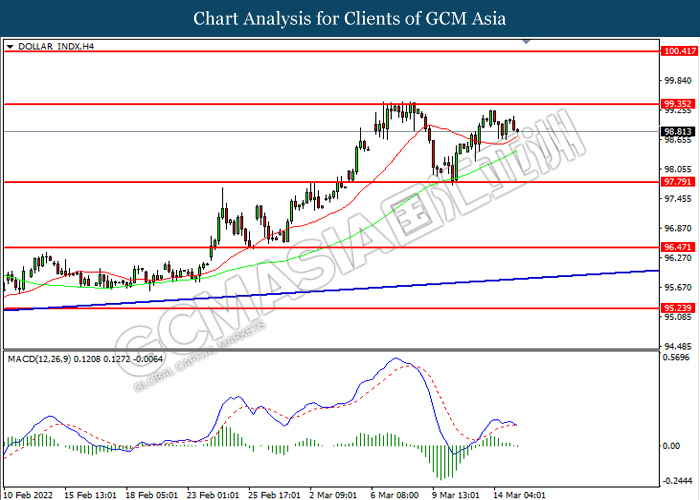

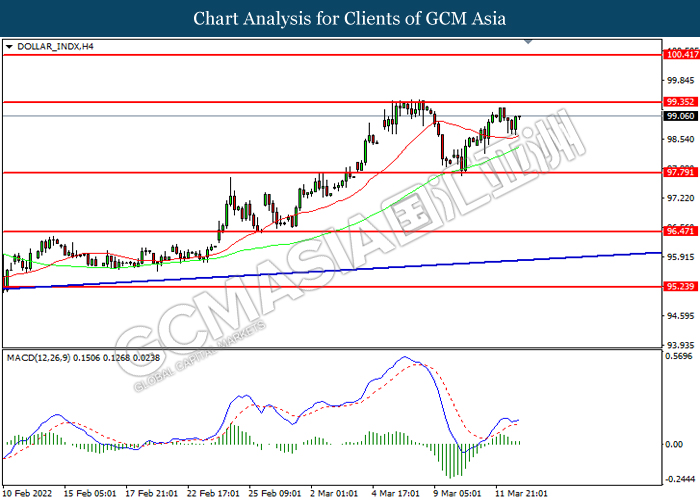

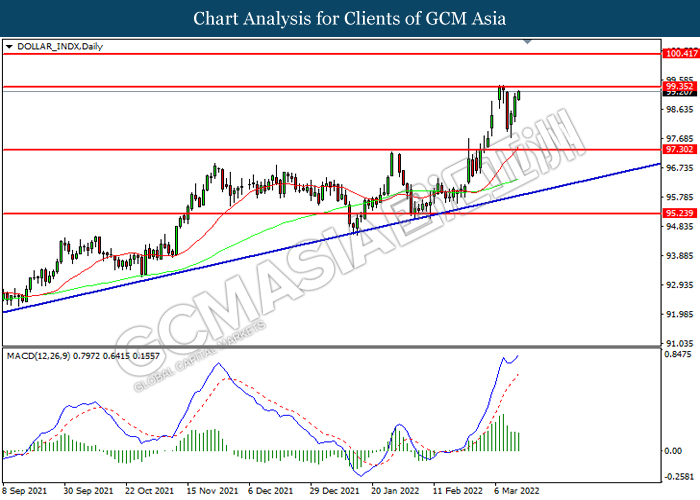

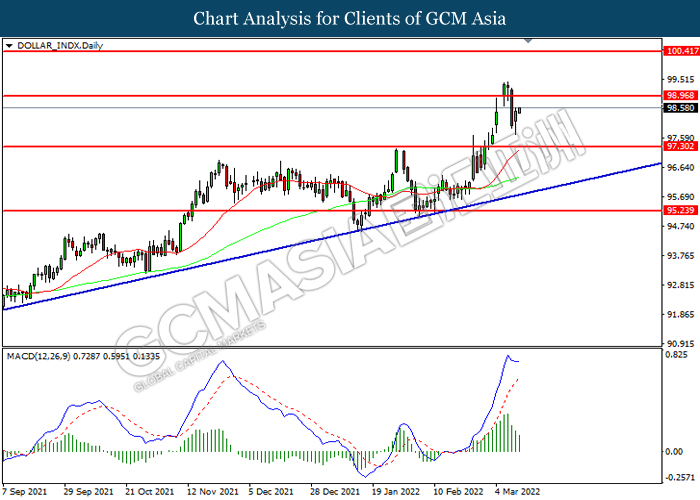

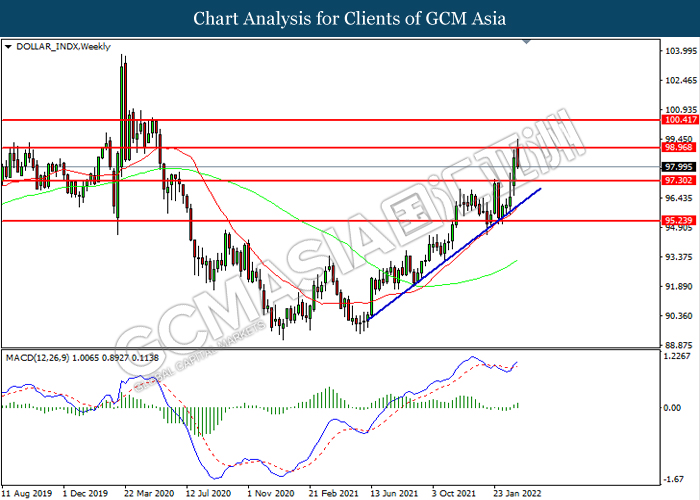

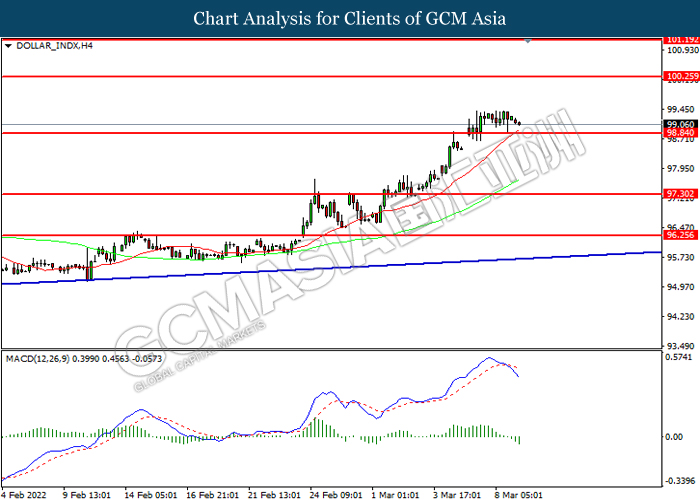

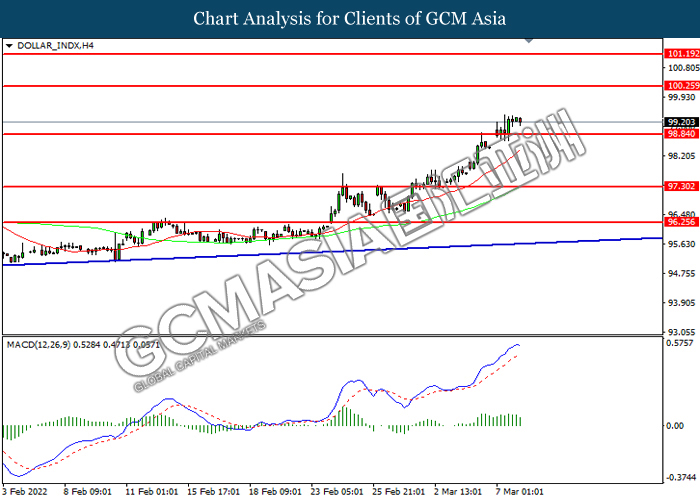

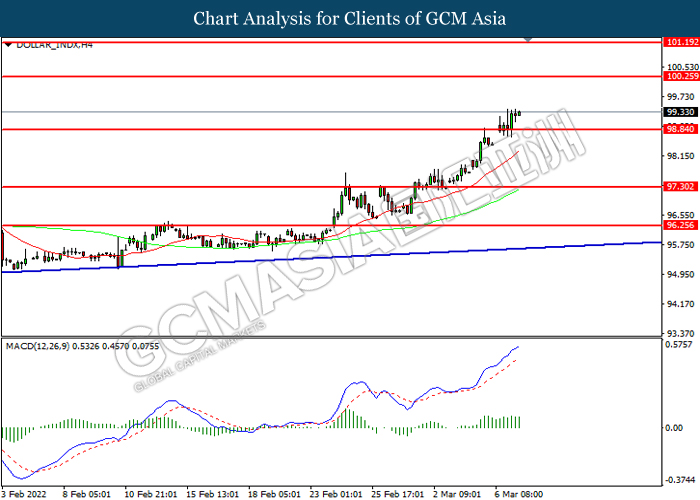

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout the resistance level.

Resistance level: 99.35, 100.40

Support level: 97.30, 96.45

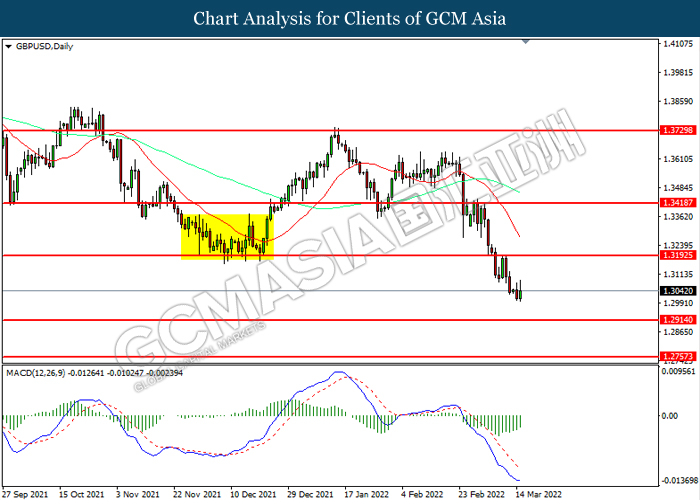

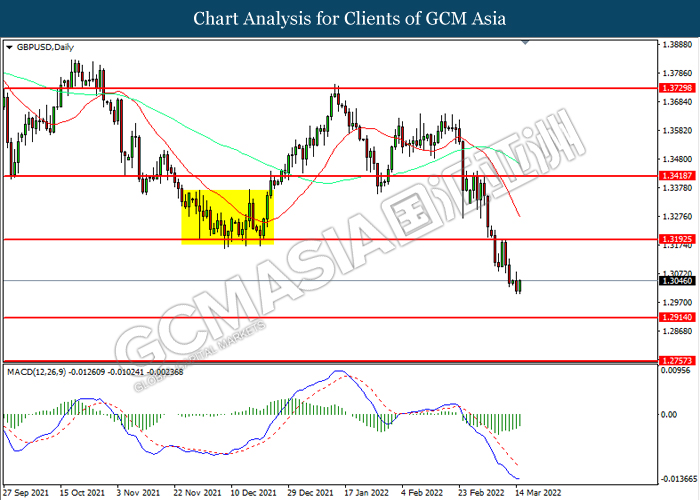

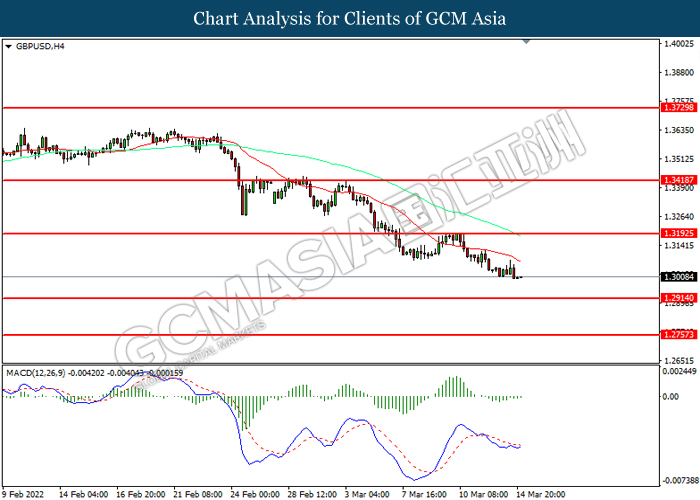

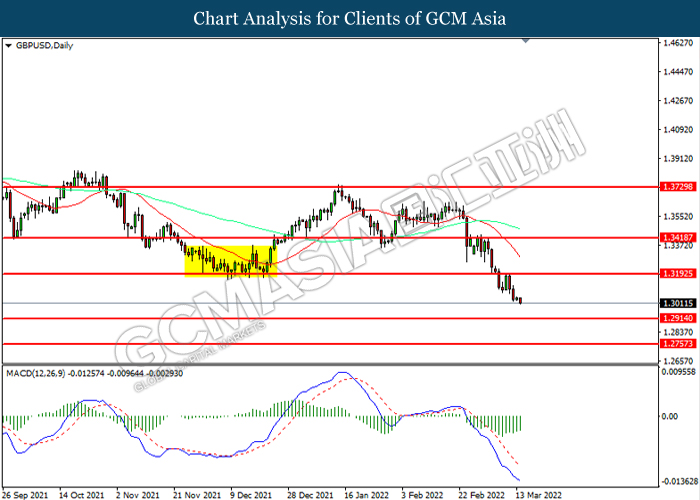

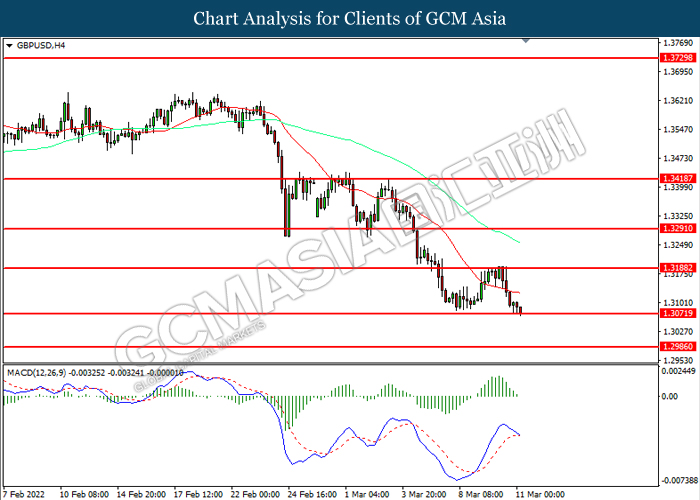

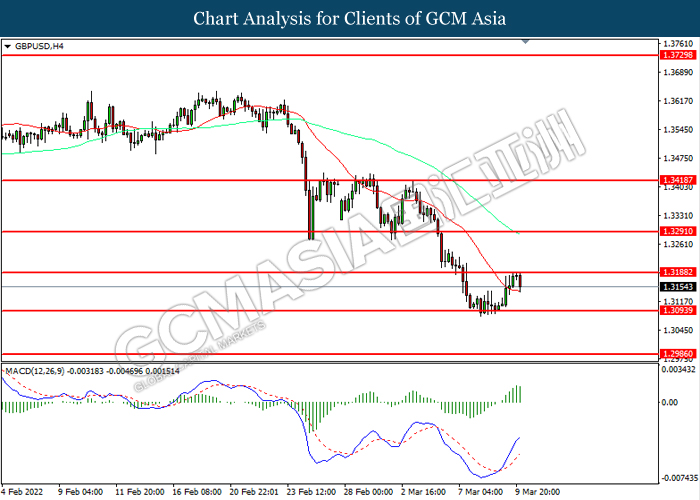

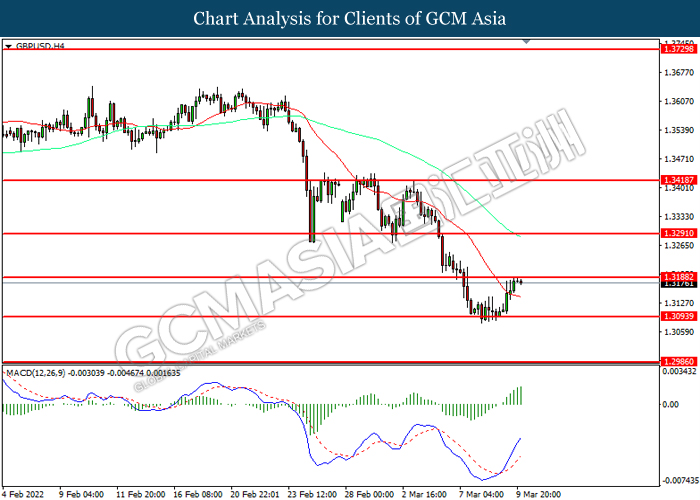

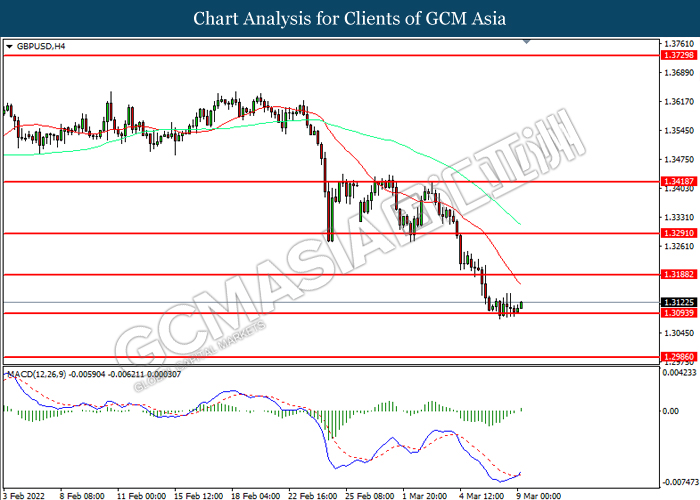

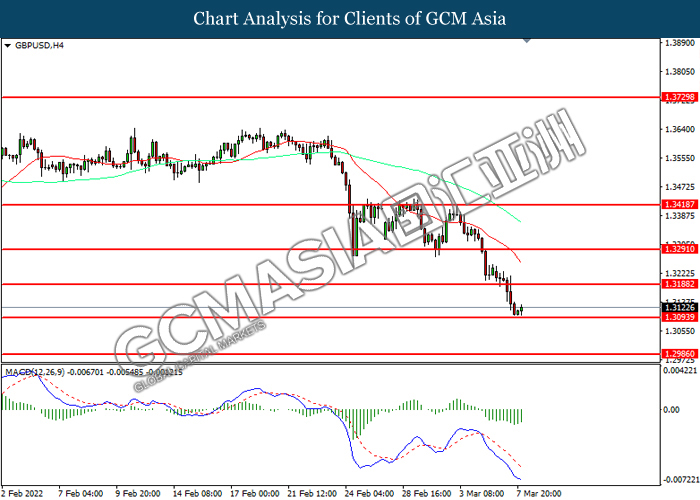

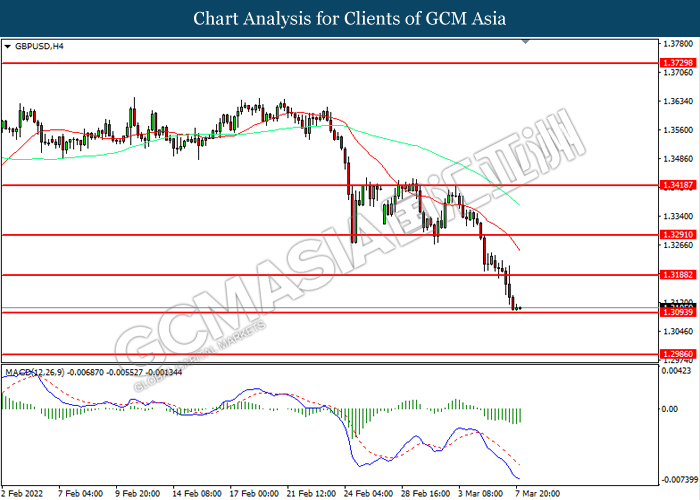

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

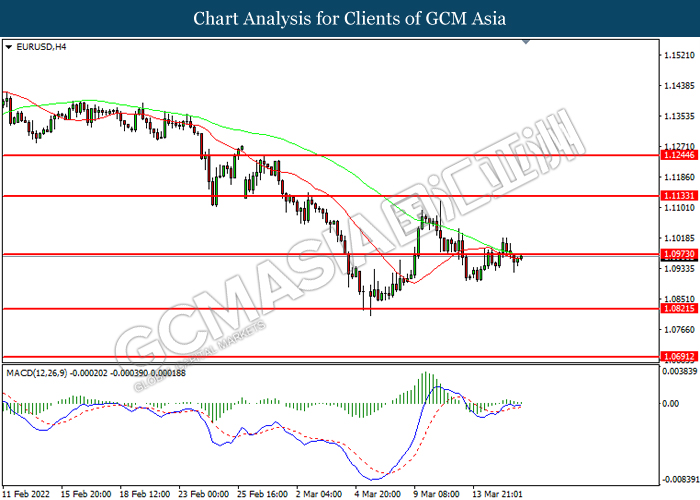

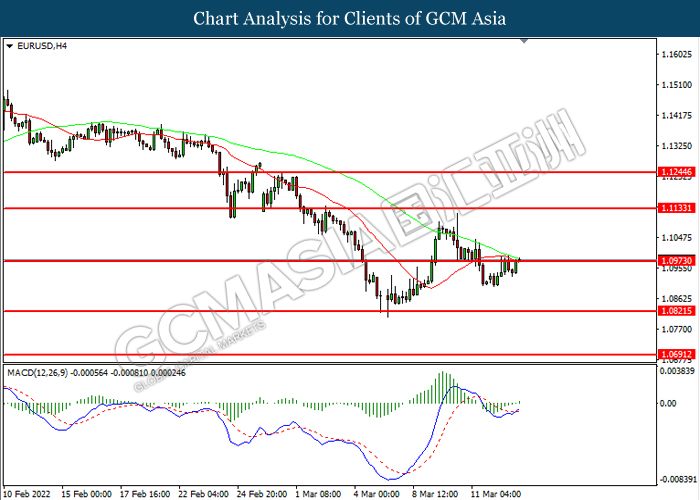

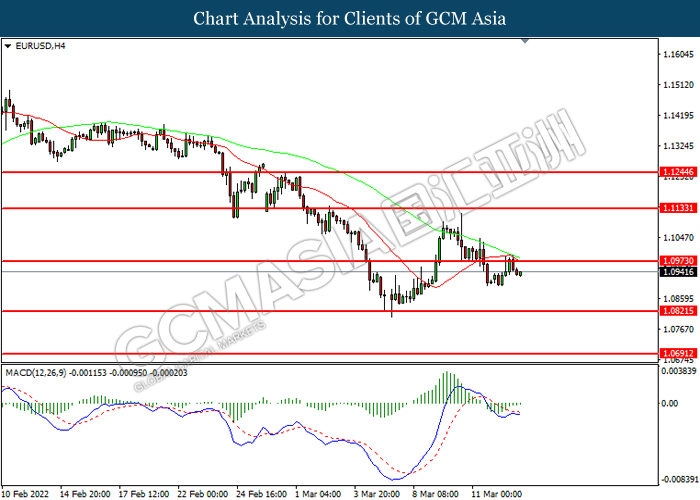

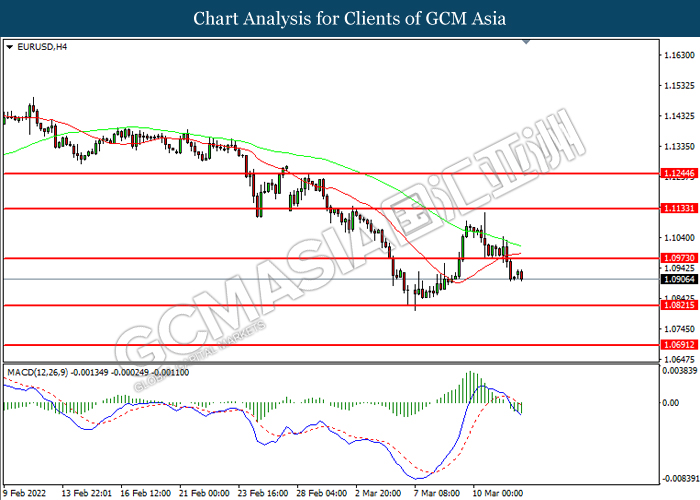

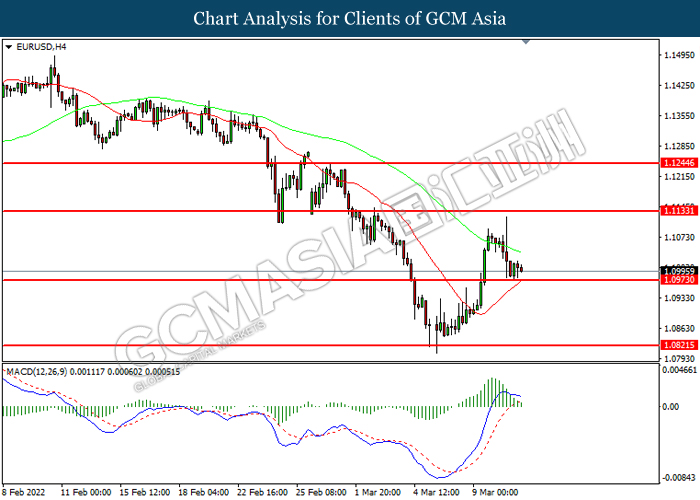

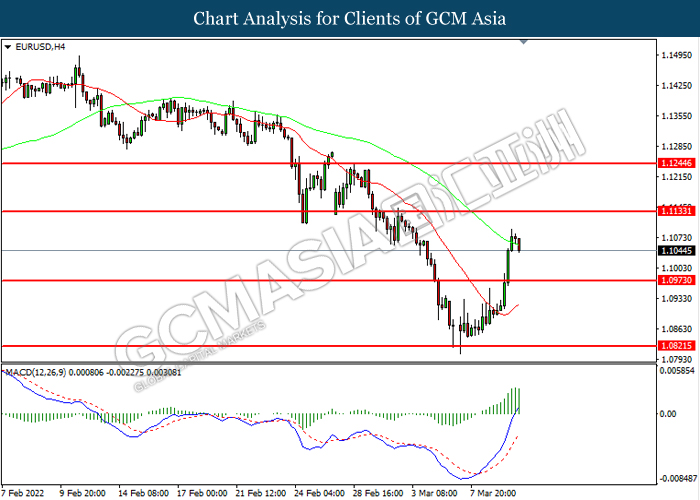

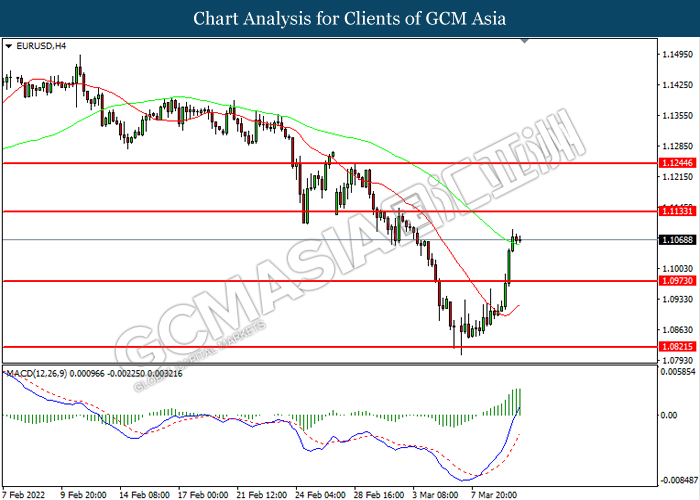

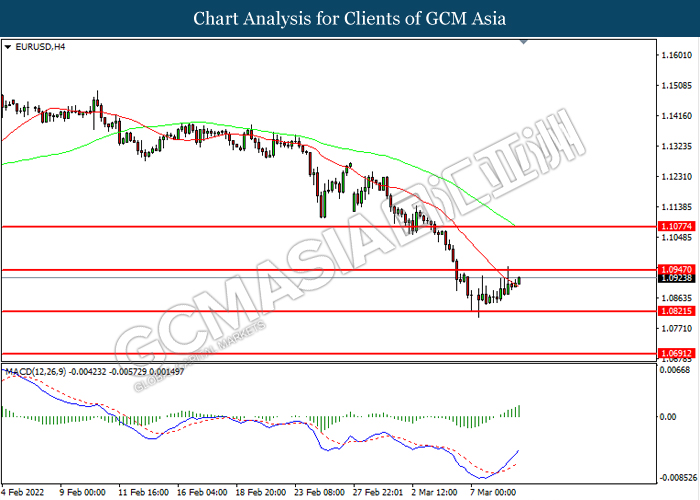

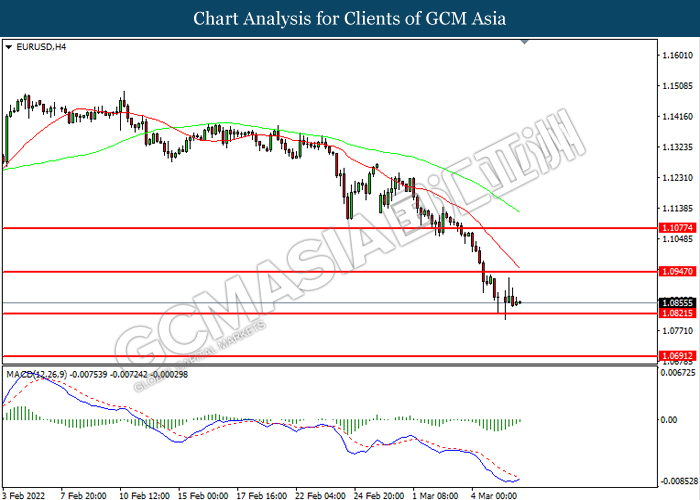

EURUSD, H4: EURUSD was traded within a range while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

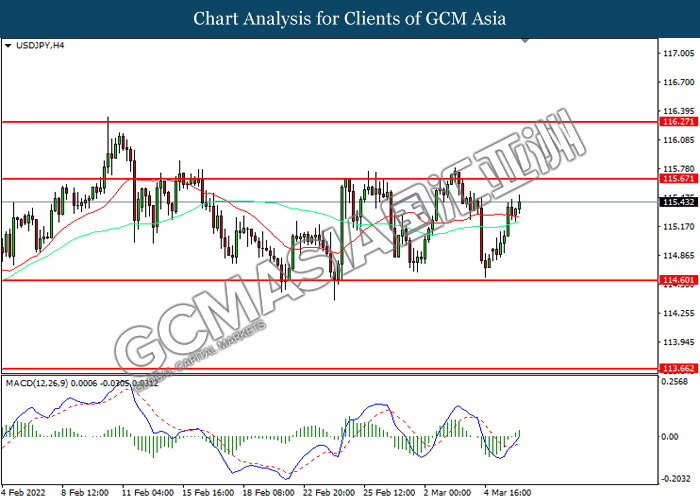

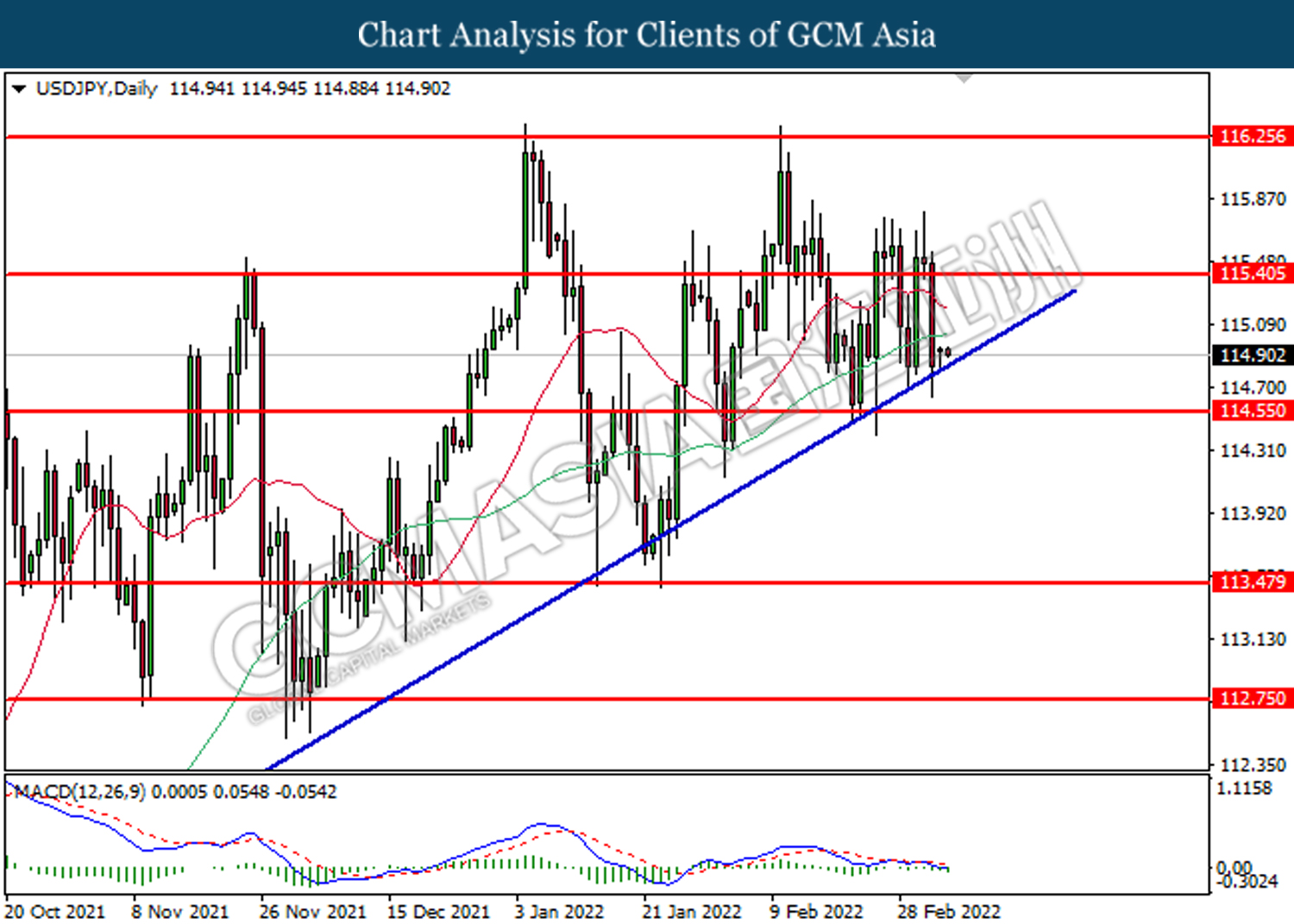

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

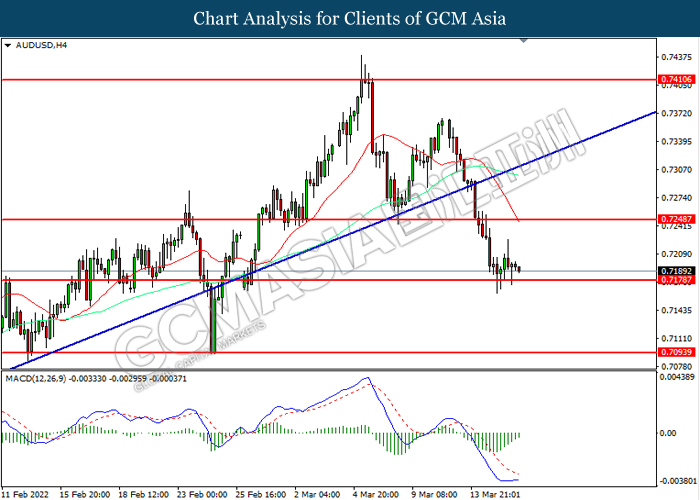

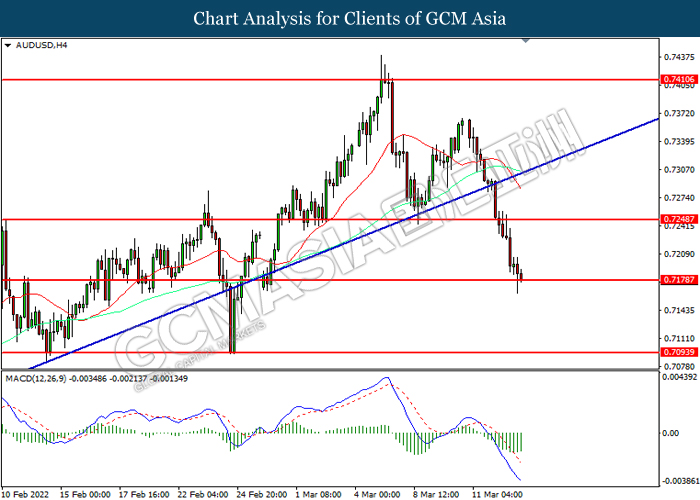

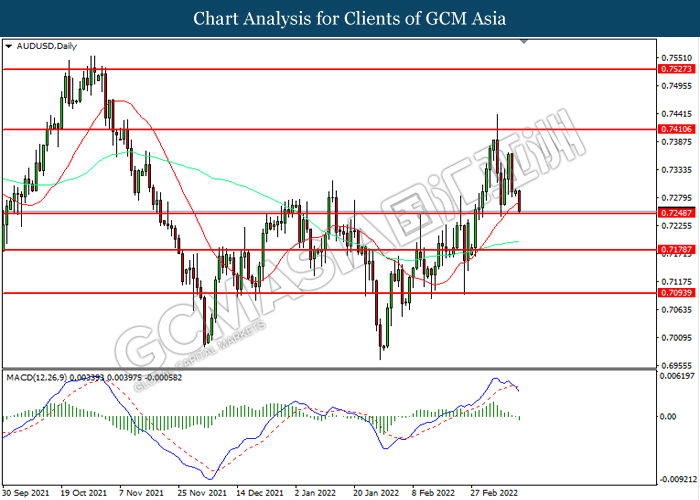

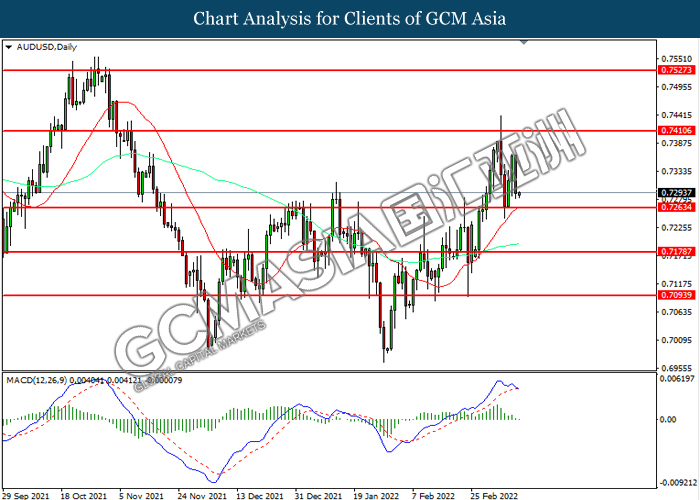

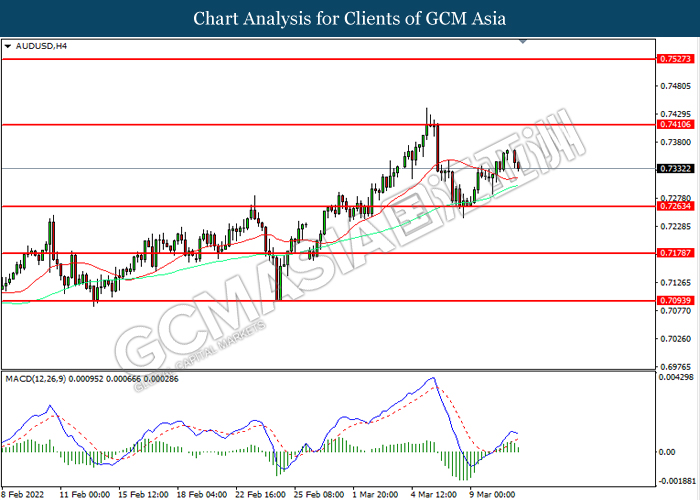

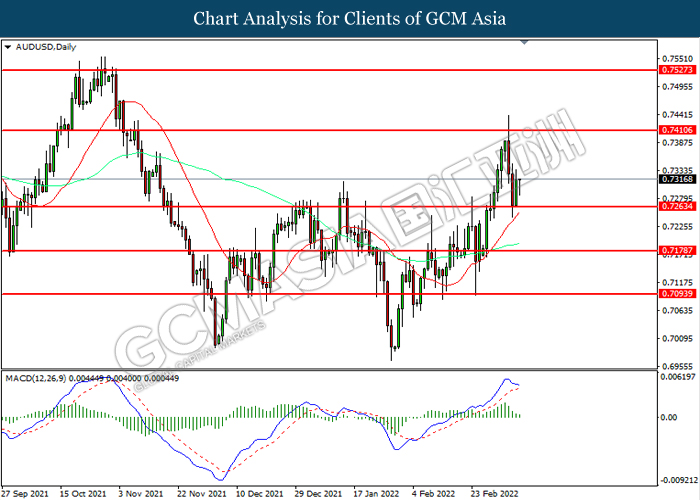

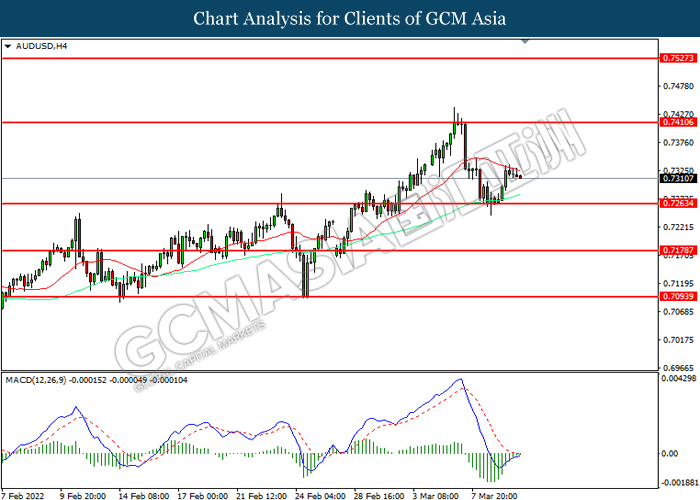

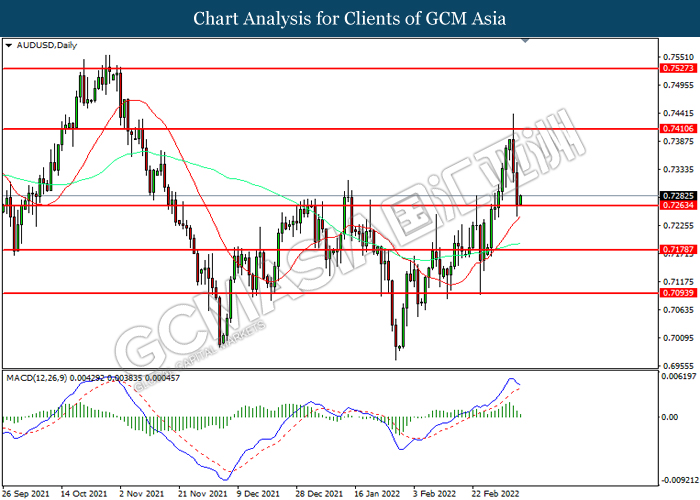

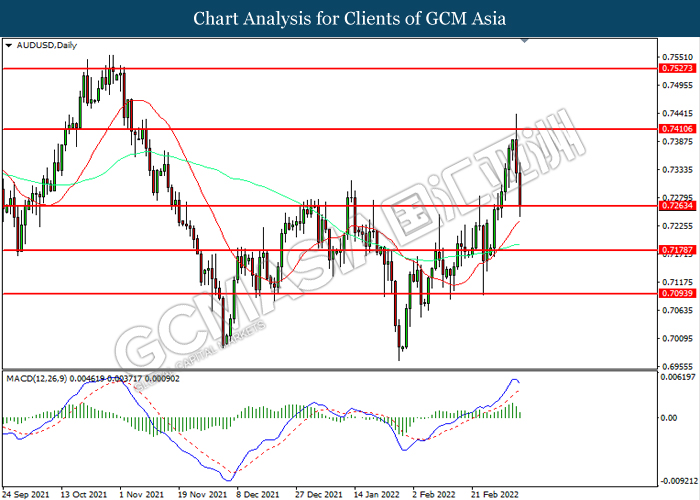

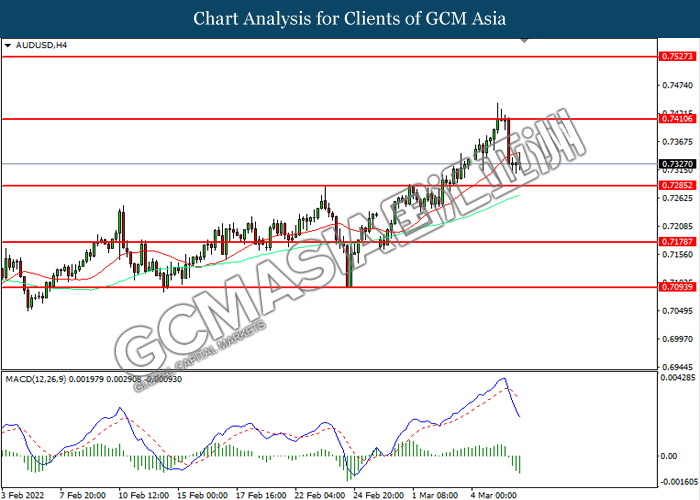

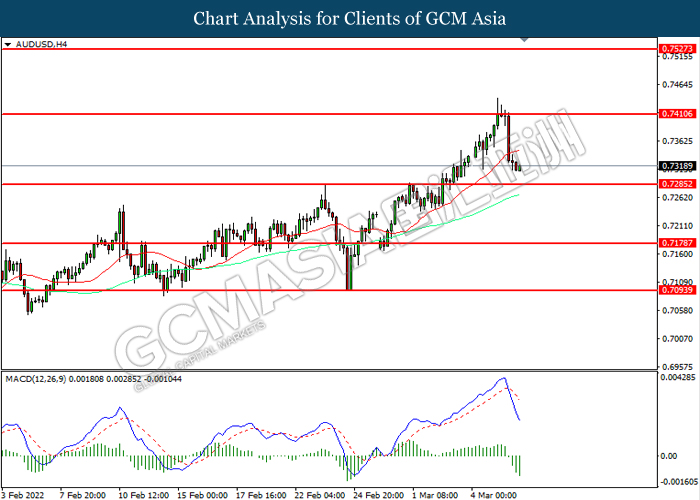

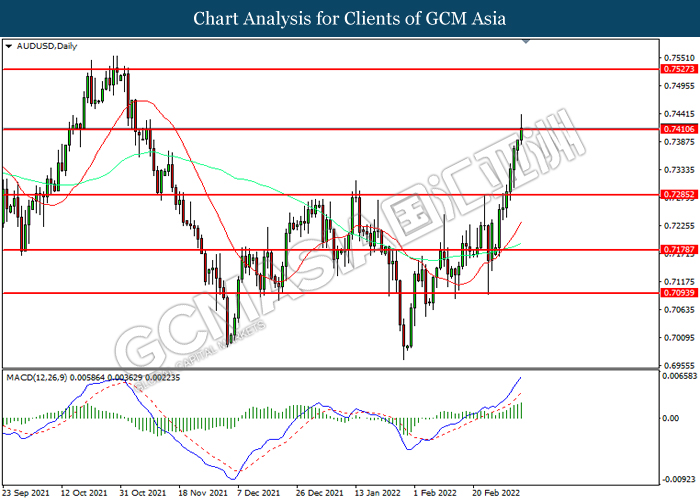

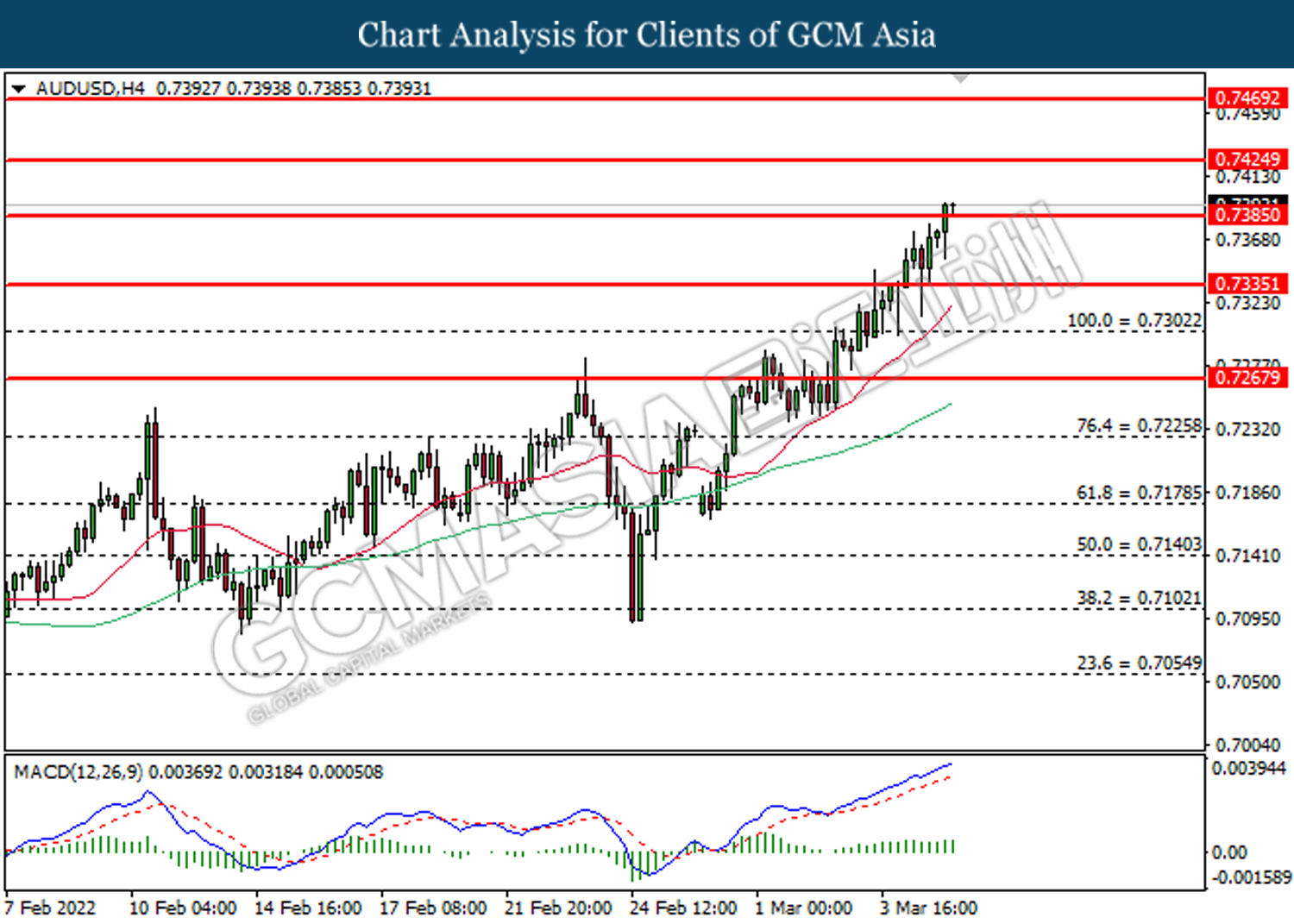

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7250, 0.7410

Support level: 0.7180, 0.7095

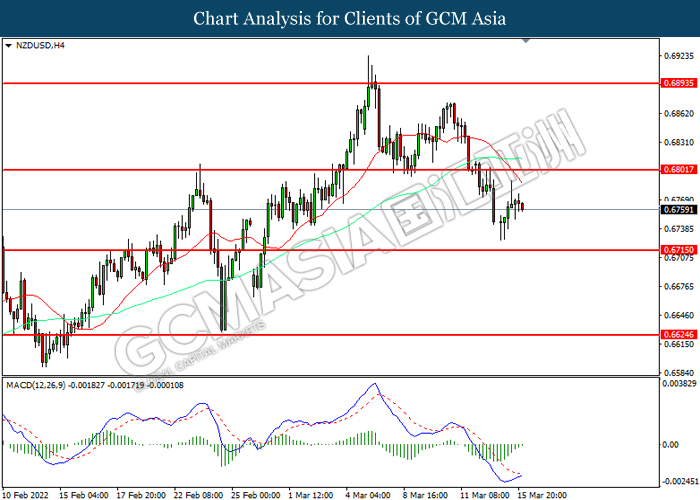

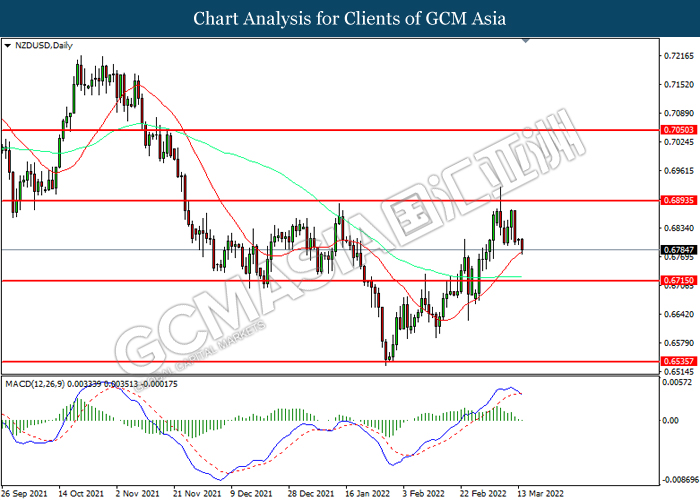

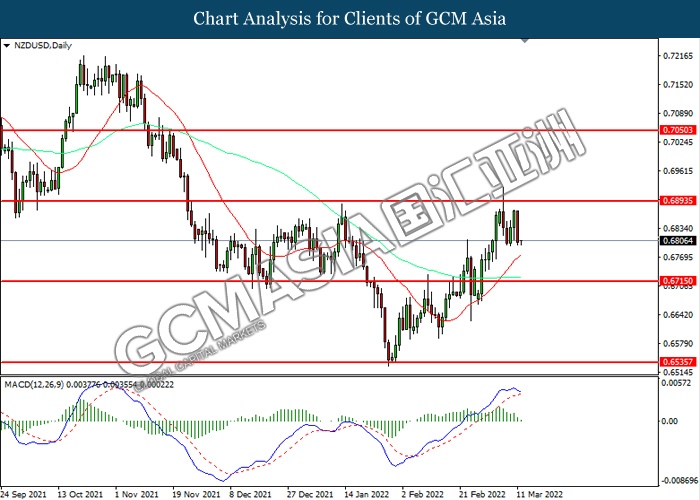

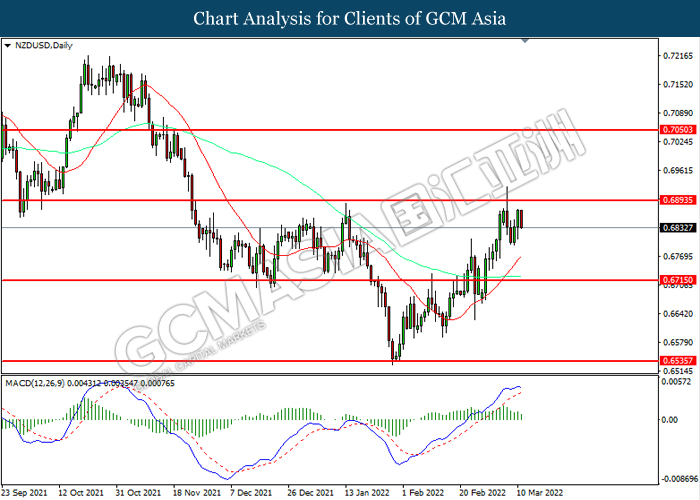

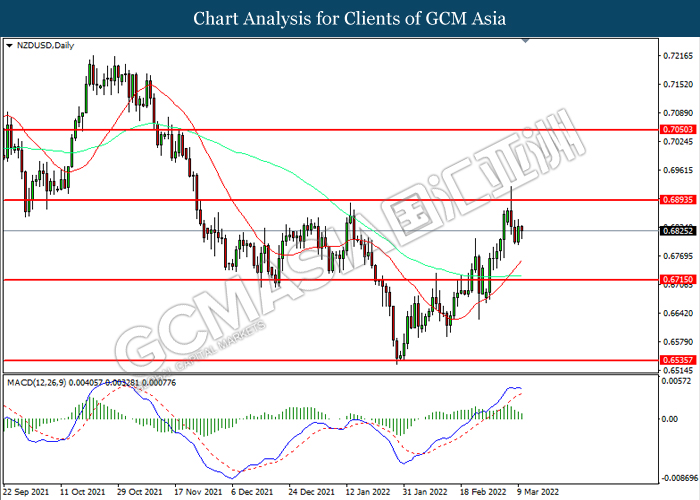

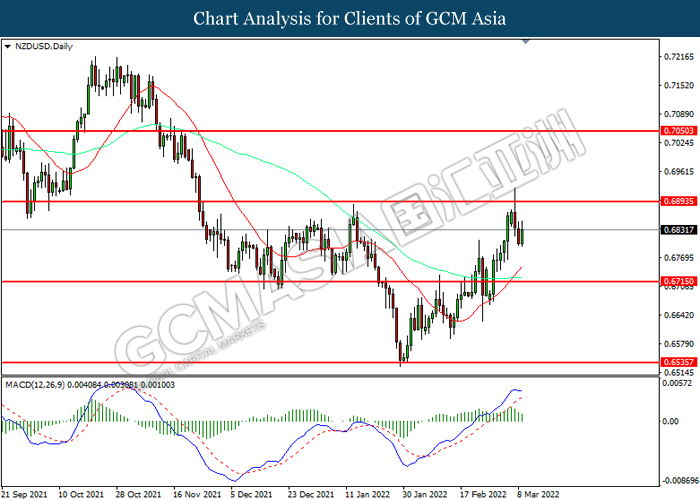

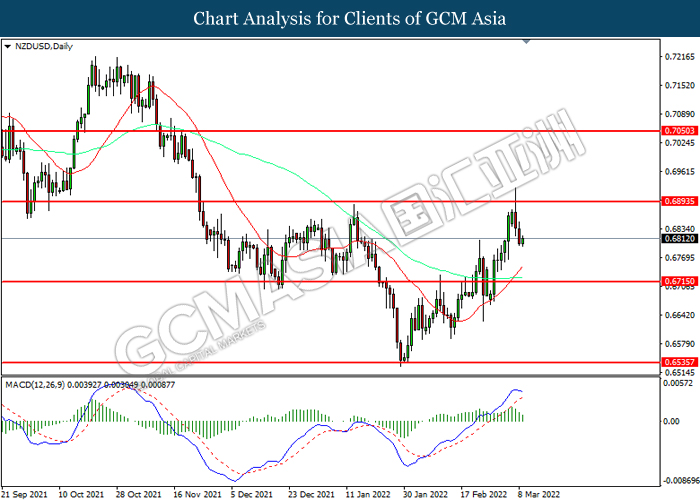

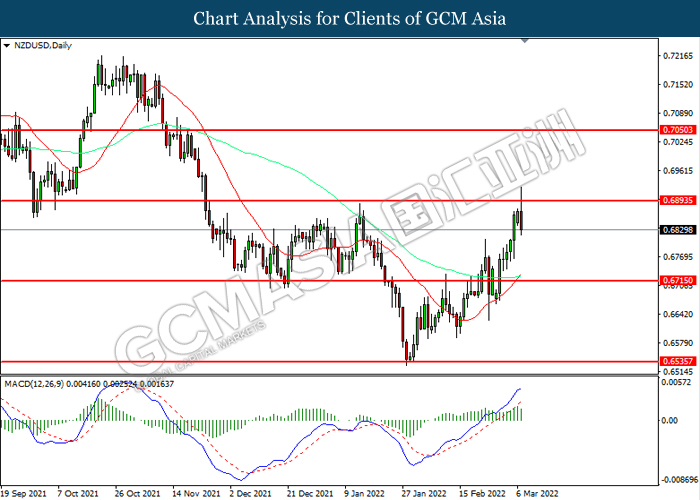

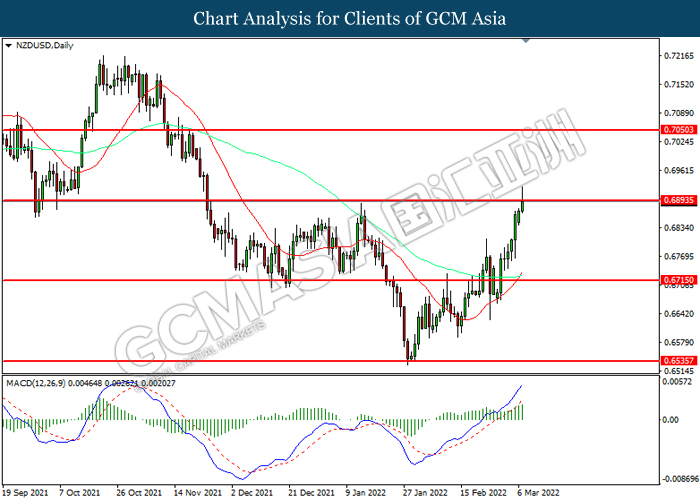

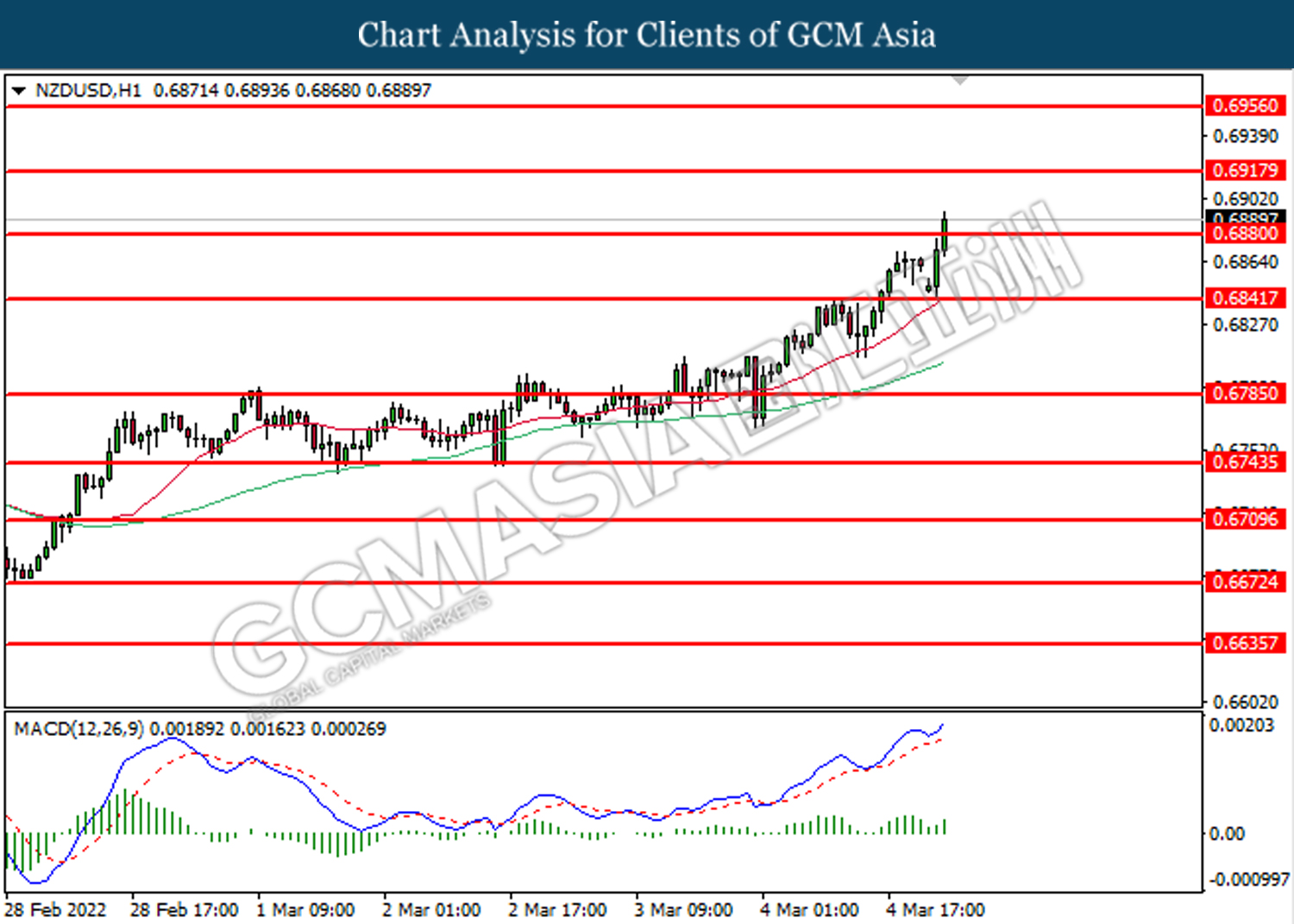

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6800, 0.6895

Support level: 0.6715, 0.6625

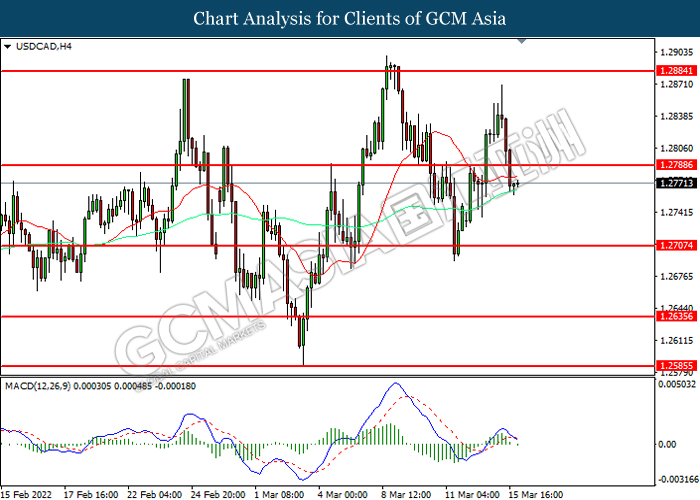

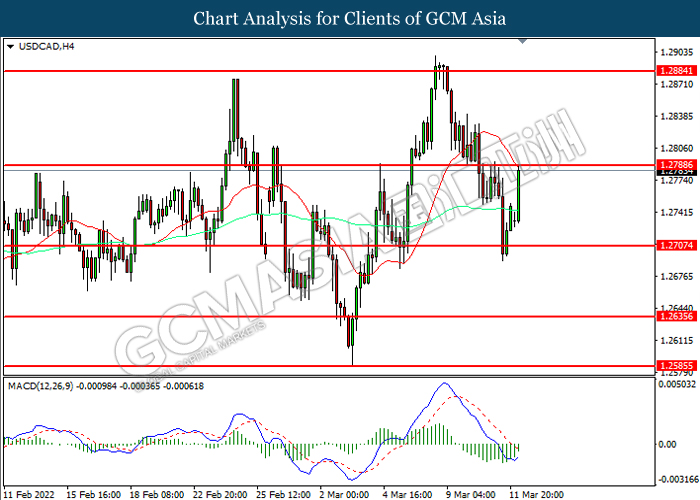

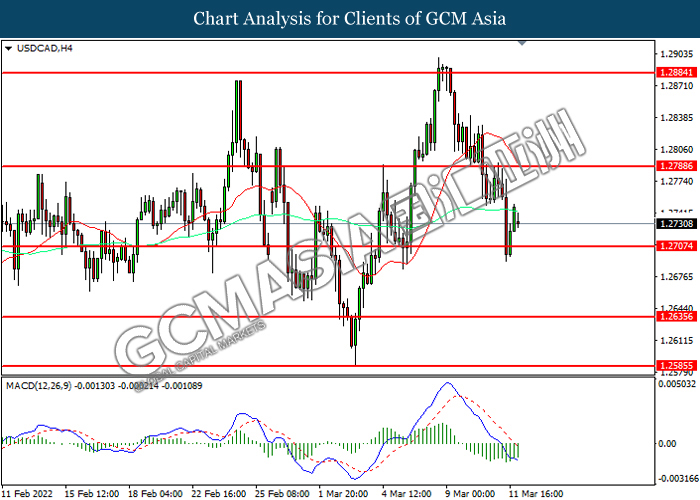

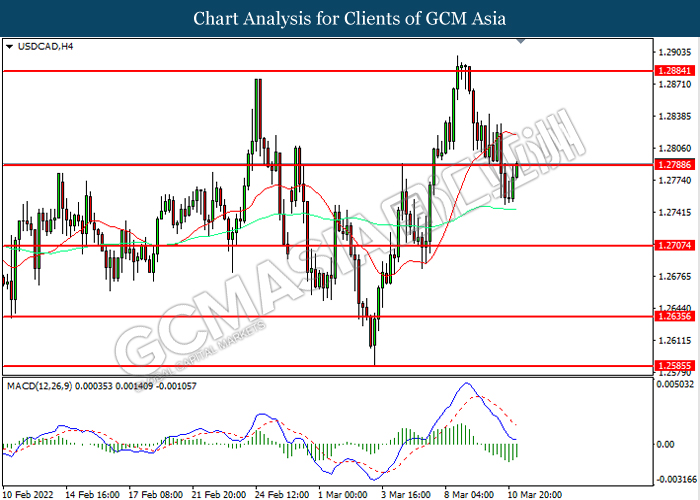

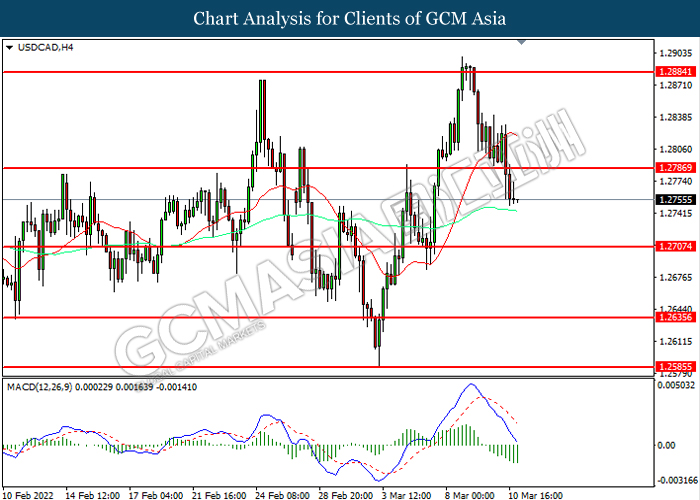

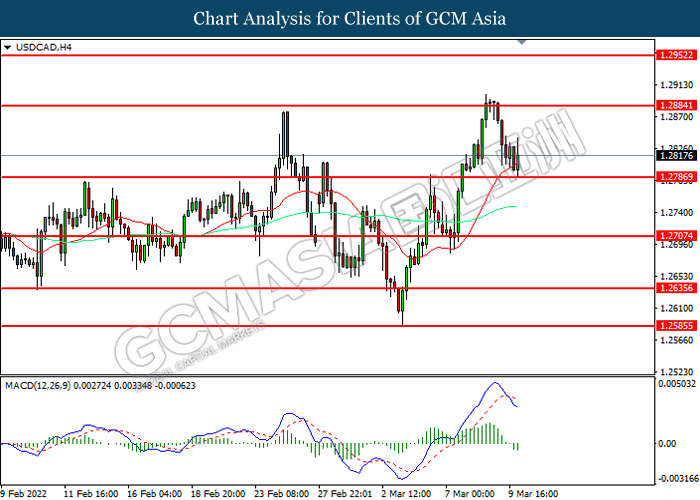

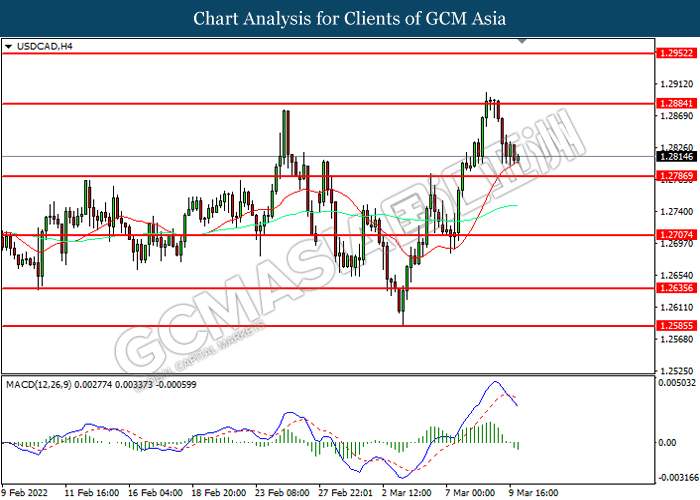

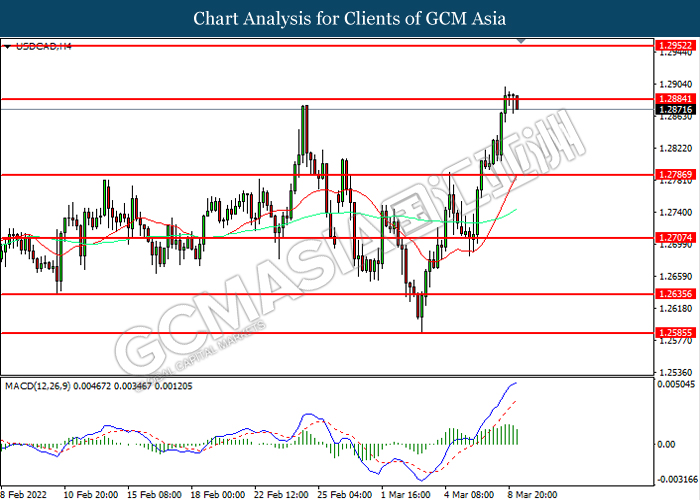

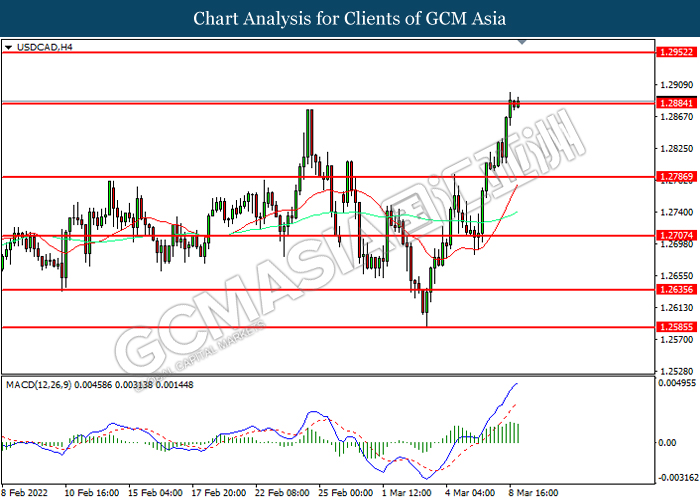

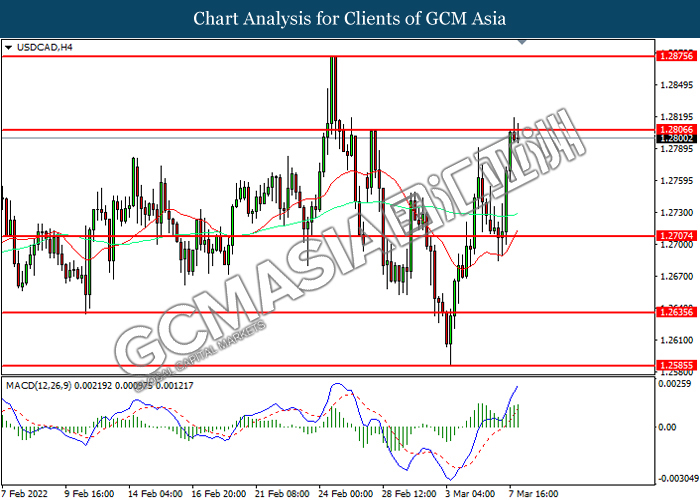

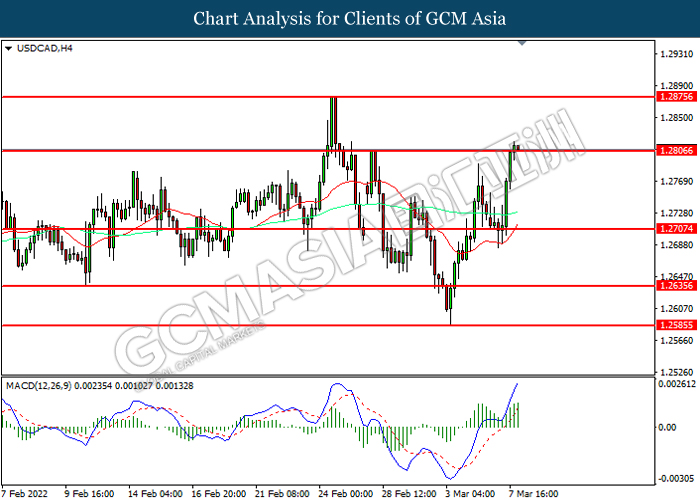

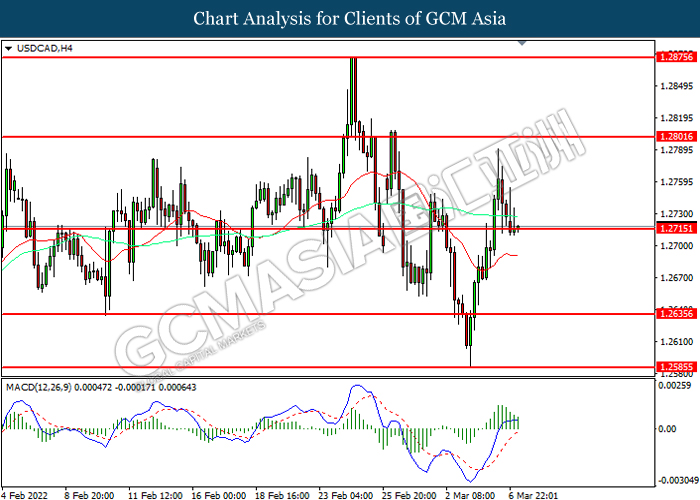

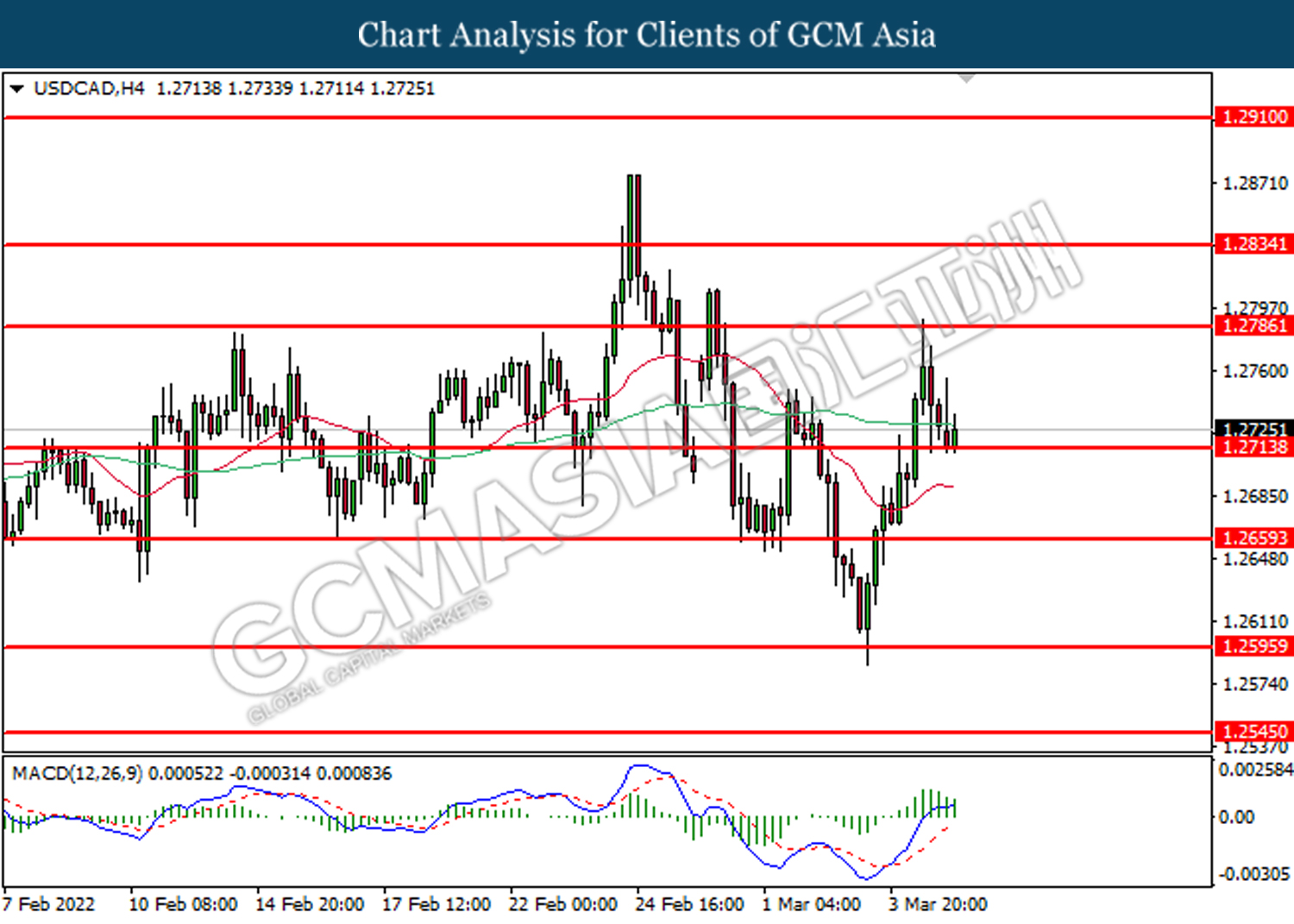

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2790, 1.2885

Support level: 1.2705, 1.2635

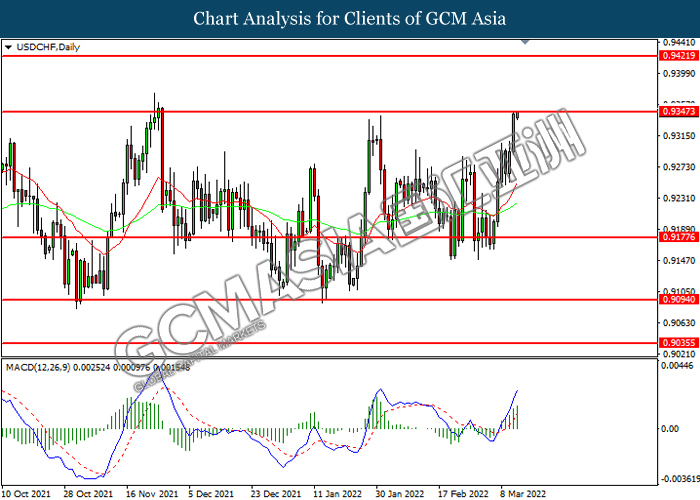

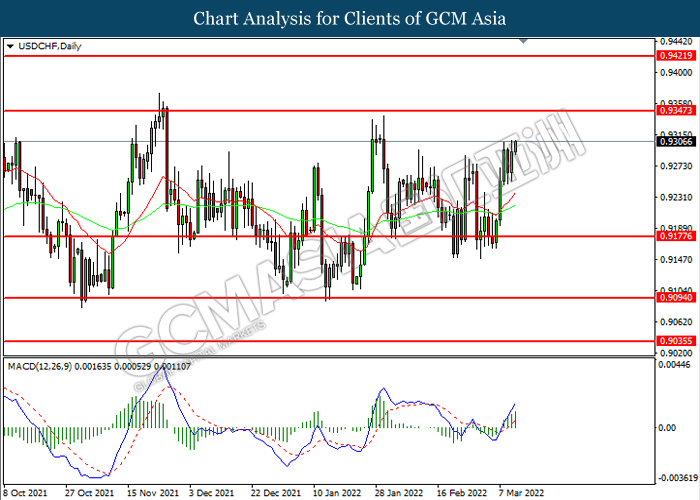

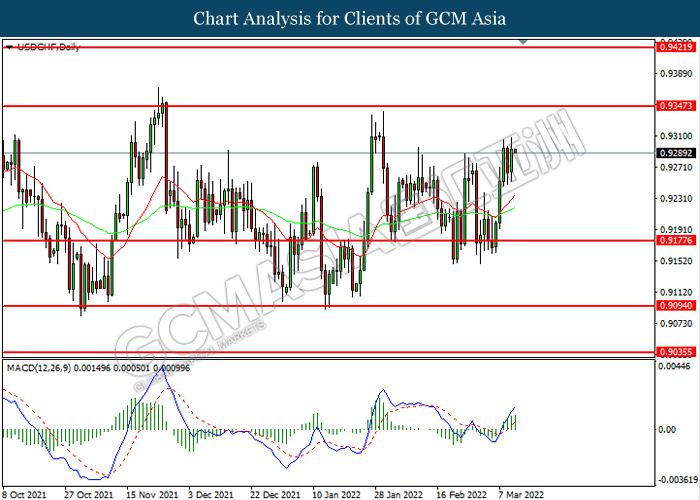

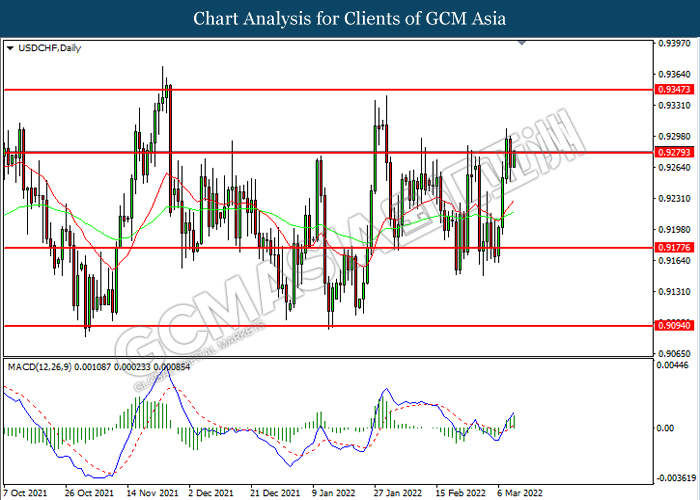

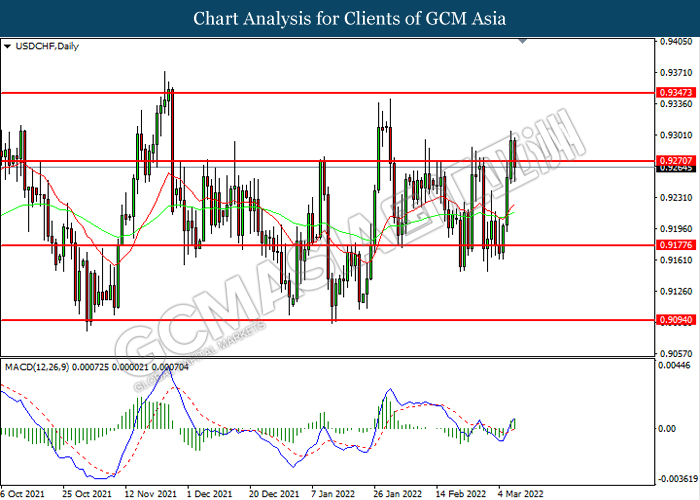

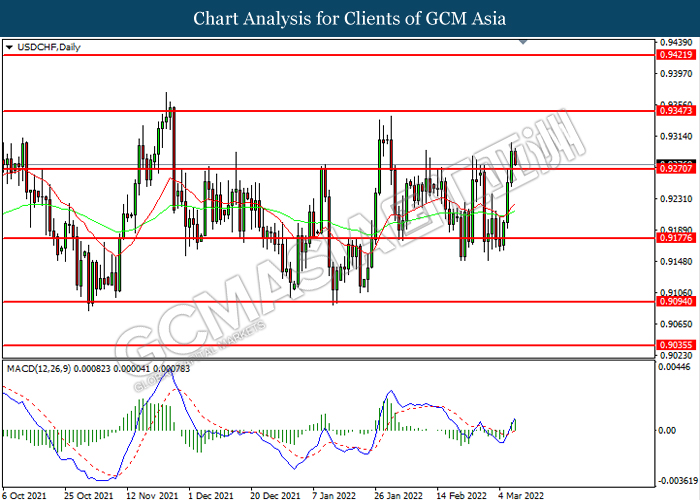

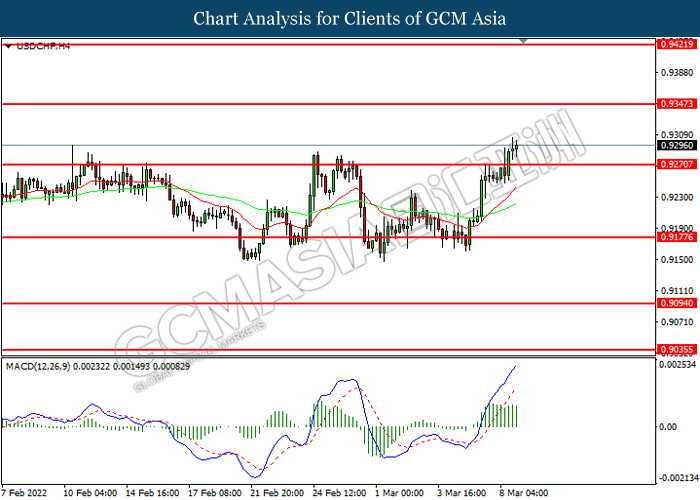

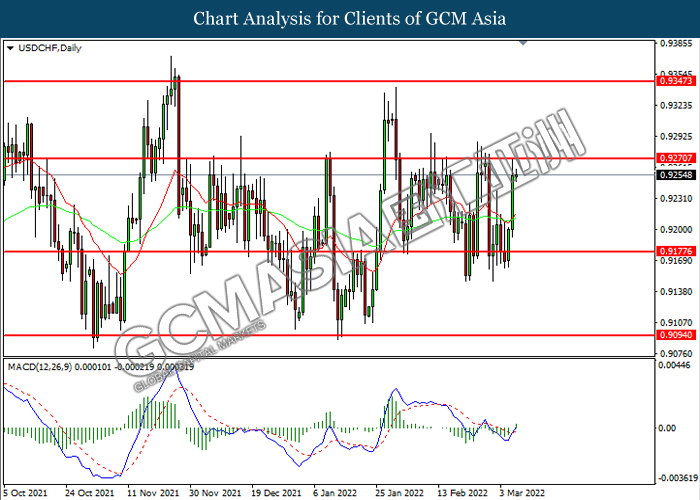

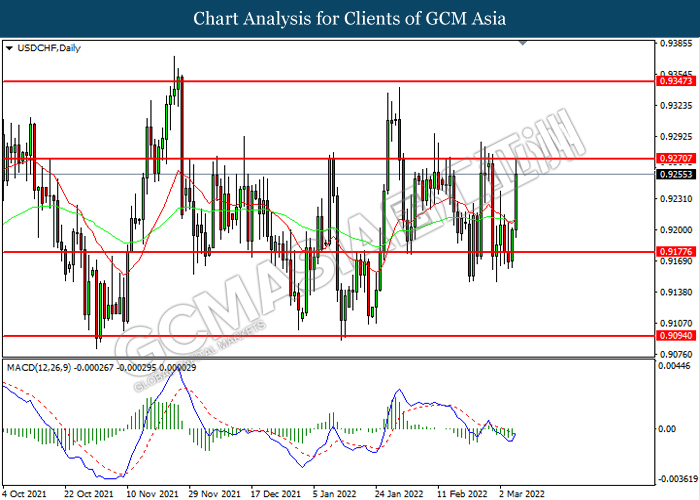

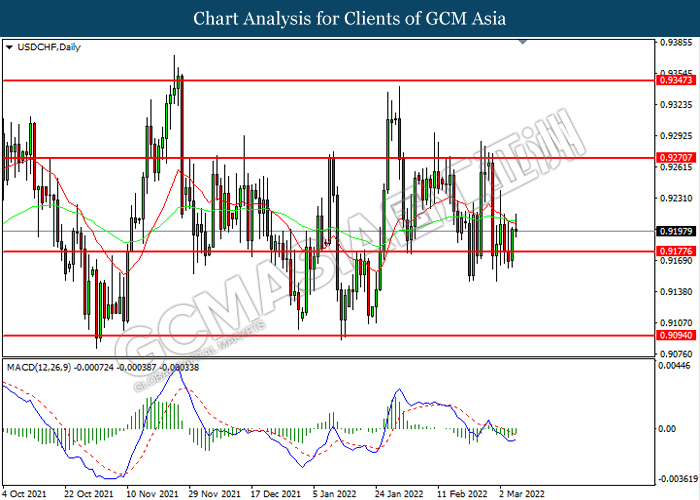

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

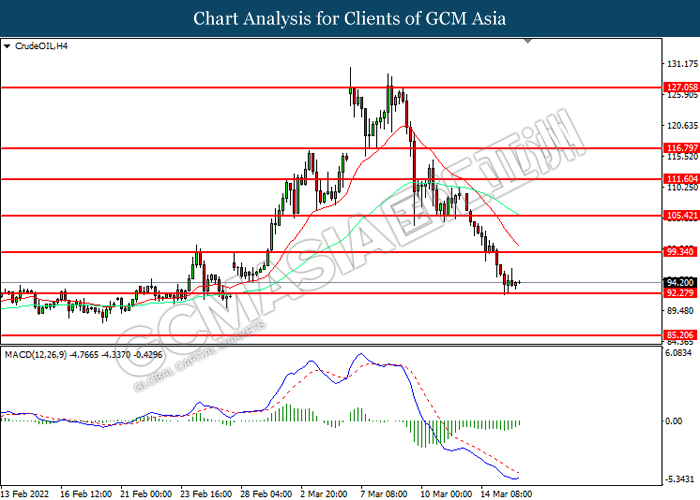

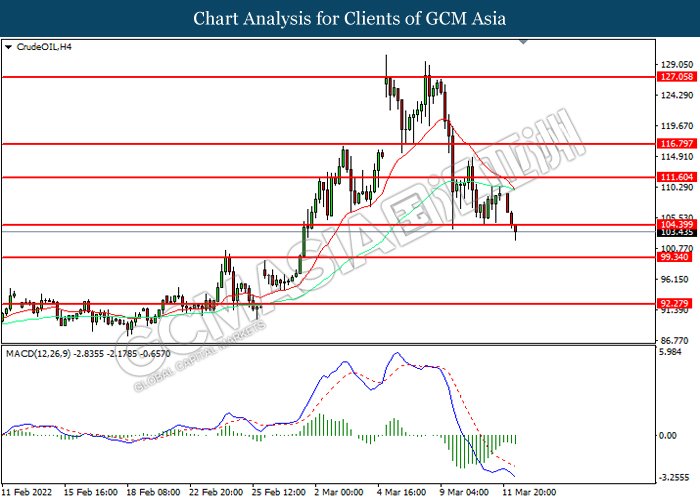

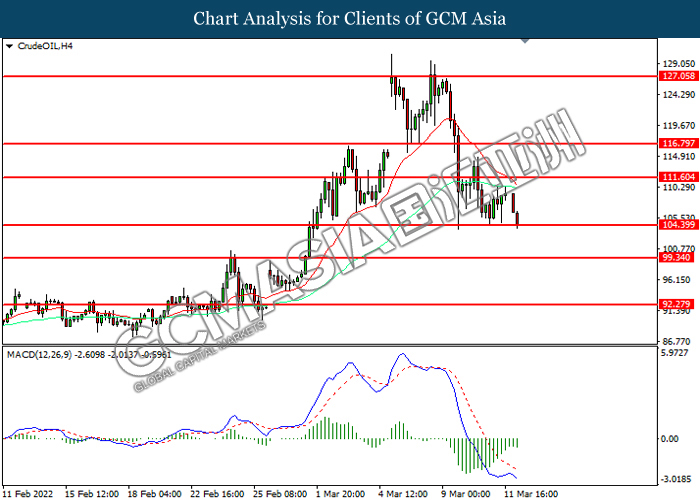

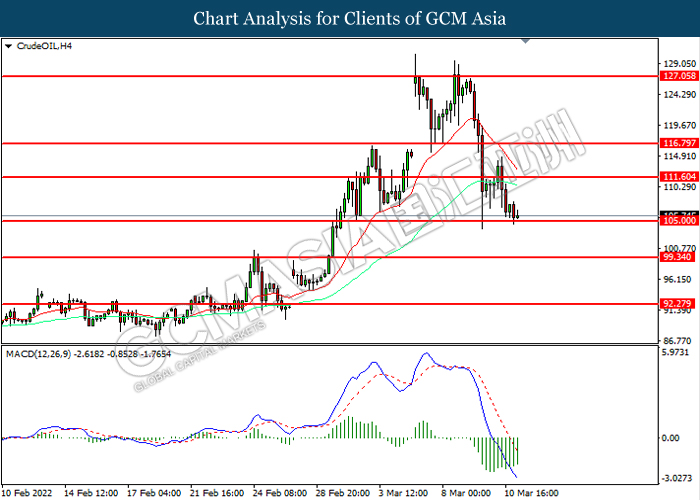

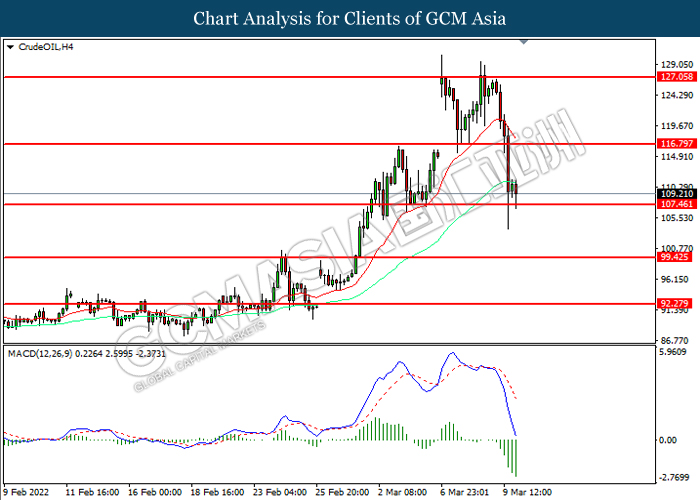

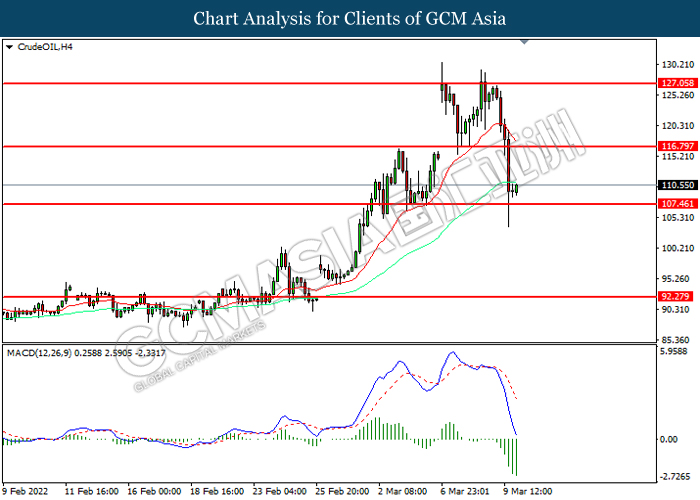

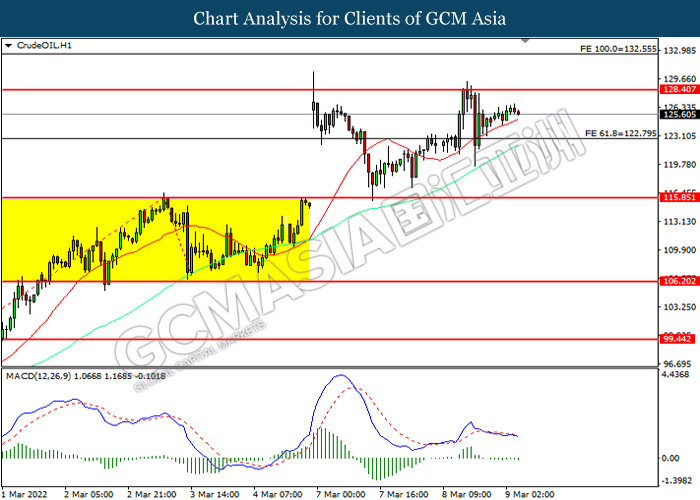

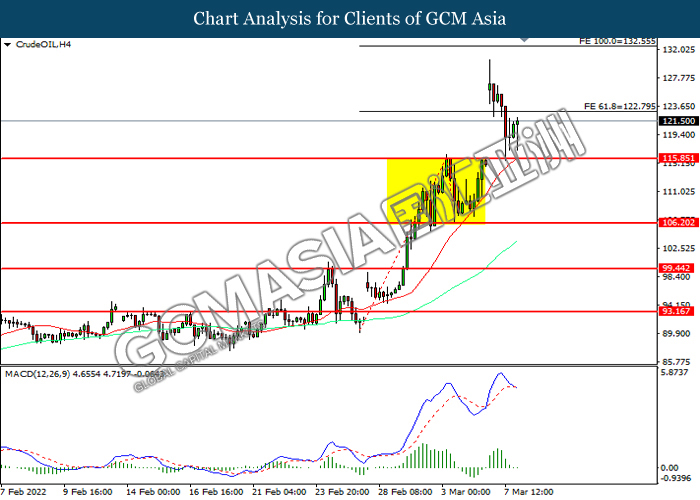

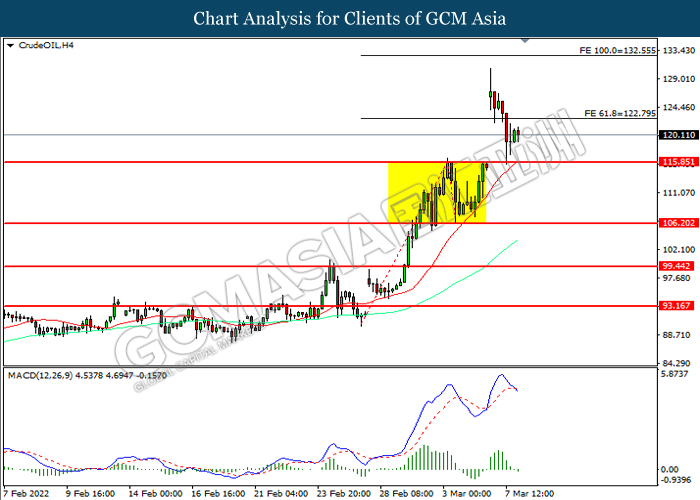

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 86.65

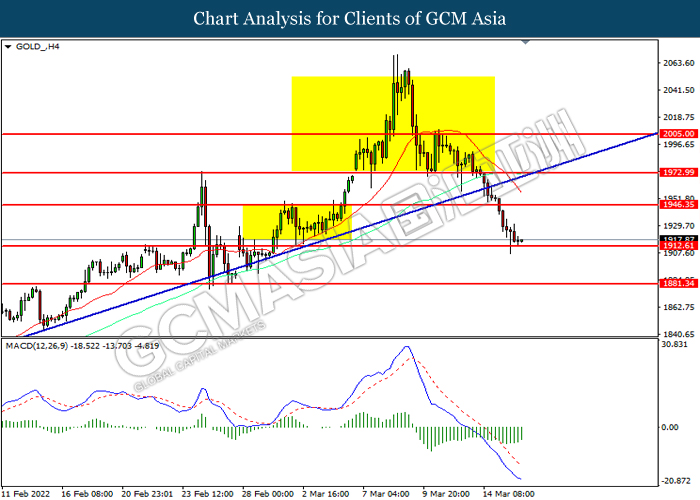

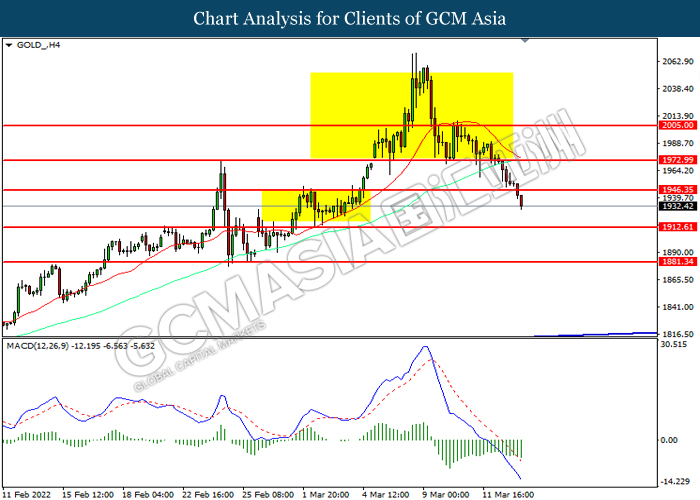

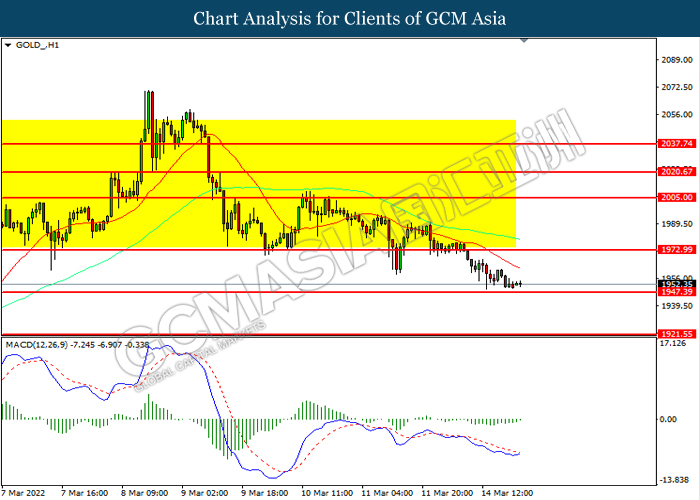

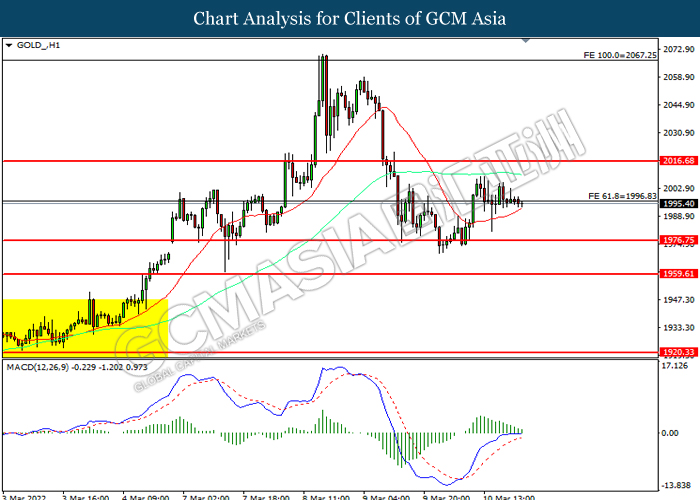

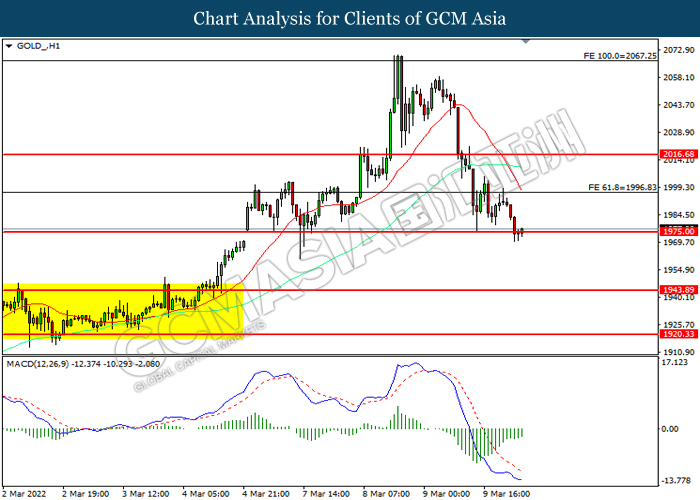

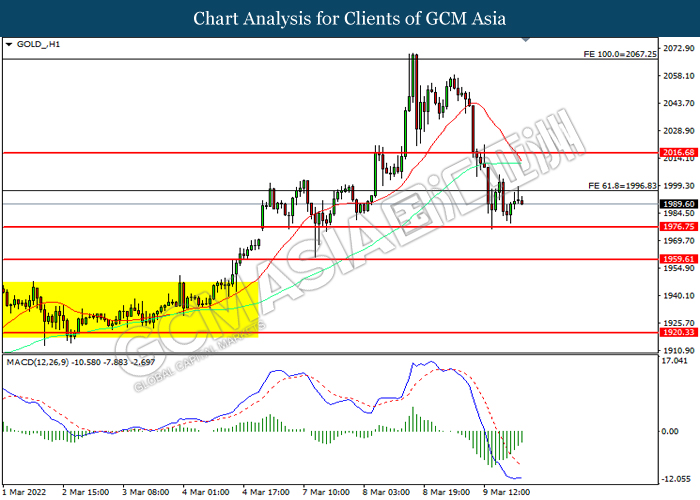

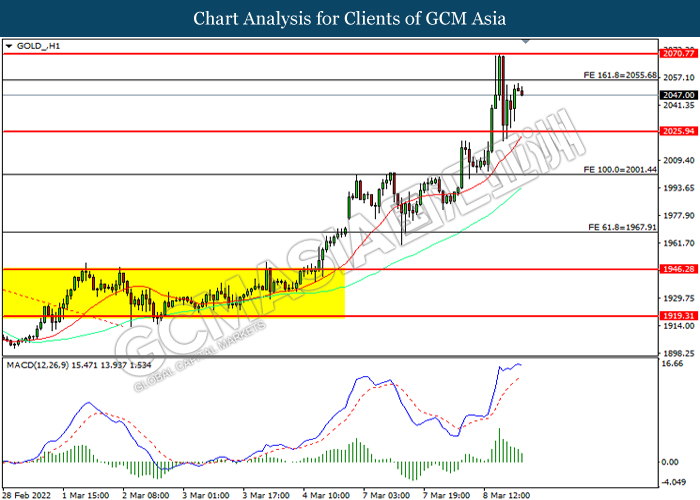

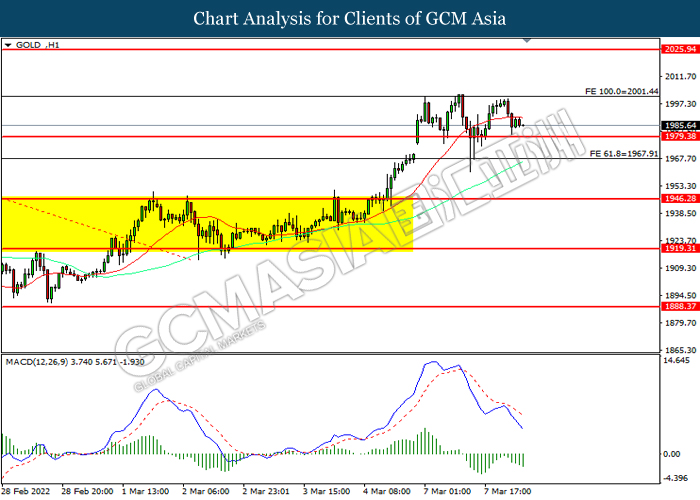

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

150322 Afternoon Session Analysis

15 March 2022 Afternoon Session Analysis

Australia Dollar slump as China Covid-19 case surge.

The Australian Dollar has slumped since yesterday amid the backdrop of surging Covid-19 cases in China. According to CNBC, Mainland China is facing its worst Covid-19 outbreak since the country clamped down on the pandemic in 2020, with major cities rushing to limit business activity. Shenzhen, the biggest city in the manufacturing hub of Guangdong province, told all businesses not involved with essential public services to suspend production or have employees work from home for a week starting Monday. Meanwhile, China had ordered about 51 million residents into lockdown, with three rounds of testing. All public transport is halted and all businesses, except essential services, will be closed until March 20. As China is the largest trading partner with Australia, it sparked negative prospects toward economic momentum in Australia region while the business activities with China are limited. It dialed down the market optimism toward Australia’s economy, spurring further bearish momentum on Australian Dollar. As of writing, the pair depreciated 0.03% to 0.7185.

In commodities market, crude oil price extends its losses by 4.11% to $98.79 per barrel as of writing amid the addition oil supply from OPEC+. Besides, gold price depreciated by 0.83% to $1944.50 per troy ounces as of writing as the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Jan) | 4.30% | 4.60% | – |

| 15:00 | GBP – Claimant Count Change (Feb) | -31.9K | -28.0K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Mar) | 54.3 | 10 | – |

| 21:30 | USD – PPI (MoM) (Feb) | 1.00% | 0.90% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.30, 96.45

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7250, 0.7410

Support level: 0.7180, 0.7095

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6895. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6800, 0.6895

Support level: 0.6715, 0.6625

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2885, 1.2950

Support level: 1.2790, 1.2705

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 99.35, 105.40

Support level: 92.30, 86.65

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35

150322 Morning Session Analysis

15 March 2022 Morning Session Analysis

US Dollar surged ahead of key FOMC meeting.

The Dollar Index which traded against a basket of six major currencies extend its gains at the start of the week ahead of key Federal Reserve policy-setting meetings. The US 10-year benchmark Treasury yield rose to 2.1419%, the highest since July 2019. Market participants speculated the Federal Reserve would at least increase the interest rate by 25 basis point this week. Though, the Federal Open Market Committee meeting will be focusing on more than a solitary interest rate hike, however. There also will be adjustments upon the economic outlook, projections for the future path of rates and likely to discuss about the bond buying program. Hence, investors would continue to remain their focus on latest development regards of the latest monetary policy statement this week to receive further trading signal. As of writing, the Dollar Index appreciated by 0.03% to 99.10.

In the commodities market, the crude oil price depreciated by 0.14% to 102.41 per barrel as of writing. The oil market extends its gains following China announced on Monday afternoon that all 24 million people in Jilin province would go into lockdown, including the previously locked down city of Changchun. On the other hand, the gold price slumped 0.03% to $1953.44 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Jan) | 4.30% | 4.60% | – |

| 15:00 | GBP – Claimant Count Change (Feb) | -31.9K | -28.0K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Mar) | 54.3 | 10 | – |

| 21:30 | USD – PPI (MoM) (Feb) | 1.00% | 0.90% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.30, 96.45

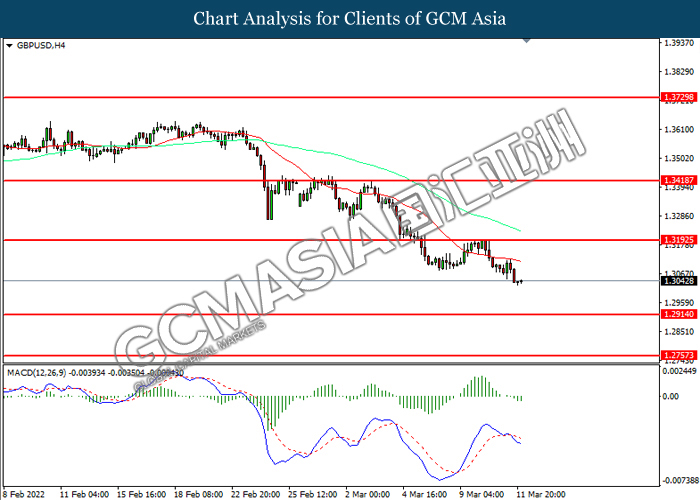

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

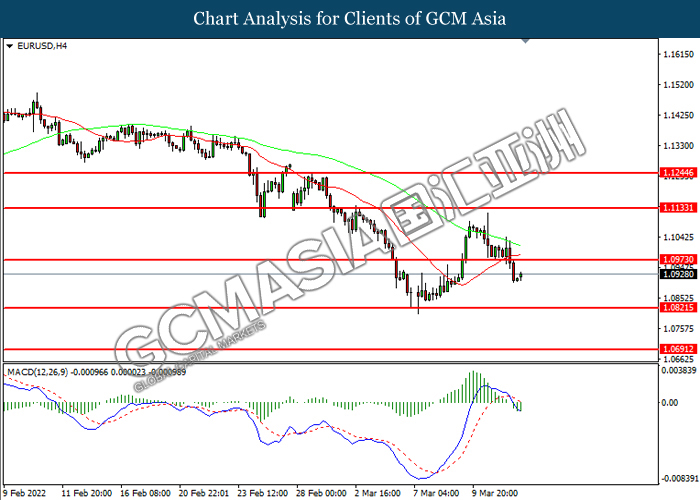

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, H4: USDJPY was traded higher following prior breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7250, 0.7410

Support level: 0.7180, 0.7095

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6895. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6800, 0.6895

Support level: 0.6715, 0.6625

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2885, 1.2950

Support level: 1.2790, 1.2705

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 105.40, 111.60

Support level: 99.35, 92.30

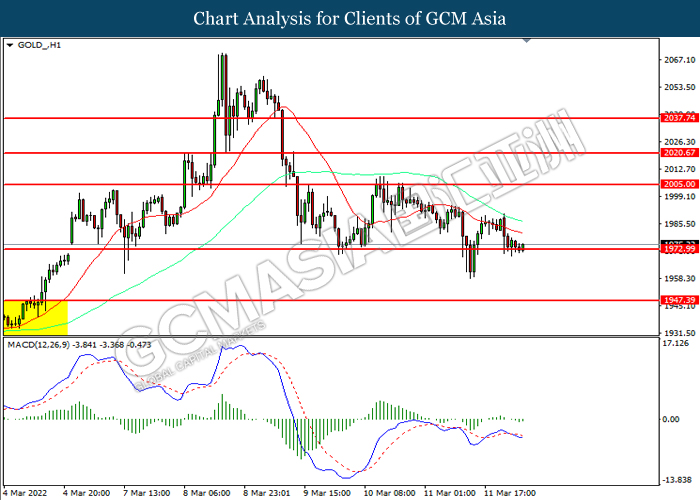

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1947.40, 1921.55

140322 Afternoon Session Analysis

14 March 2022 Afternoon Session Analysis

Euro slumped amid tensions between Russia-Ukraine continued.

Euro have been beaten down since Friday under rising tension of Russia-Ukraine conflict. According to Reuters, a Ukrainian official appeared a fact on Sunday, Russia attacked a base near the Polish border and fighting raged elsewhere. A barrage of Russian missiles hit Ukraine’s Yavoriv International Centre for Peacekeeping and Security, a base just 15 miles (25 km) from the Polish border that has previously hosted NATO military instructors, killing 35 people and wounding 134. Despite diplomatic efforts to end the war in Ukraine stepped up on Monday, with Ukrainian and Russian negotiators set to talk again after both sides cited progress, it sparked negative prospect toward the economic momentum in European region indeed as the circumstance did not go through into a peaceful way after the negotiations between both parties. It dialed down the market optimism toward economy conditions of European, led investors to selloff Euro and spurring further bearish momentum on the pair. Investors should continue to scrutinize the latest updates with regards of Russia-Ukraine conflict to receive further trading signals on Euro. As of writing, Euro appreciated by 0.01% to 1.0910.

In commodities market, crude oil price depreciated by 2.98% to $106.12 per barrel as of writing upon oil supply additions from OPEC+. Besides, gold price depreciated by 0.26% to $1979.80 per troy ounces as of writing amid the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 117.50. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 117.50, 118.90

Support level: 116.25, 114.60

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6895. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2790. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.2785, 1.2885

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9360, 0.9420

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 104.40. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 104.40, 111.60

Support level: 99.35, 92.30

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 2005.00, 2020.65

Support level: 1973.00, 1947.40

140322 Morning Session Analysis

14 March 2022 Morning Session Analysis

US Dollar surged on rising yield.

The Dollar Index surged over the backdrop of hawkish expectation from Federal Reserve this week. Earlier, the commodities price increased to their highest level since 2008 on growing supply shock following the implementation of sanction upon Russia. The spiking commodities price would likely to spark inflation risk in future, increasing the probability for the Federal Reserve to rate hike while sending the US 10-year Treasury yield edged higher following it dropping to its lowest level in two months. The US Core Consumer Price Index (CPI) notched up from the previous reading of 6.0% to 6.4%, exceeding the market forecast at 5.9% while hitting the 40-years high. The US Federal Reserve is scheduled to release its next policy statement on 16th March 2022. As for now, investors would continue to scrutinize the latest updates from Federal Reserve as well as geopolitical tensions between Russia-Ukraine to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.03% to 99.05.

In the commodities market, the crude oil price depreciated by 1.59% to $108.25 per barrel as of writing amid hopes upon the rising oil supply from OPEC+. On the other hand, the gold price depreciated by 0.44% to $1979.75 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 117.50. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 117.50, 118.90

Support level: 116.25, 114.60

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded lower following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2785, 1.2885

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9345, 0.9420

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 111.60, 116.80

Support level: 104.40, 99.35

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 2005.00, 2020.65

Support level: 1973.00, 1947.40

110322 Afternoon Session Analysis

11 March 2022 Afternoon Session Analysis

Euro retreated as Dollar pumped.

Euro started to ease after the pumping on yesterday. Yesterday, European Central Bank’s announced it will phase out its monetary stimulus in the third quarter, while the dollar strengthened after a strong US inflation report. As the inflation risk was soaring in the future amid the backdrop of Russia invasion of Ukraine, it increased the odds of Federal Reserve to execute tightening monetary policy in order to diminish money circulation in US, spurring upward momentum on Dollar. Investors are prompted to purchase Dollar and selloff Euro. However, the retreat of Euro was limited as ECB would stop pumping Euro into market in third quarter as ECB remained concern on war-driven inflation risk would likely to depreciate Euro in future. Thus, ECB decided to decrease money supply to offset inflation risk. As of writing, Euro edged up by 0.15% to 1.0999.

In the commodities market, crude oil price appreciated by 0.01% to 106.03 per barrel as of writing. However, the overall trend for crude oil remained bearish as UAE committed to increase oil supply. On the other hand, gold price depreciated by 0.21% to 1996.15 as of writing due to the rallies of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EUR Leader Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) | -0.20% | – | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Jan) | 0.20% | 0.20% | – |

| 21:30 | CAD – Employment Change (Feb) | -200.1K | 160.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after successfully breakout.

Resistance level: 1.3190, 1.3290

Support level: 1.3070, 1.2985

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0975, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 117.50, 118.90

Support level: 116.25, 114.60

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correcton.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2785, 1.2885

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9345, 0.9420

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 111.60, 116.80

Support level: 105.00, 99.35

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level.. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower.

Resistance level: 2005, 2020.65

Support level: 1973.00, 1947.40

110322 Morning Session Analysis

11 March 2022 Morning Session Analysis

Dollar surged amid hawkish expectation from Fed.

The Dollar Index which traded against a basket of six major currencies rebounded over the backdrop of hawkish expectation from the Federal Reserve following the year-on-year CPI hits 40-years high yesterday. According to Bureau of Labor Statistics, US Core Consumer Price Index (CPI) YoY notched up significantly from the previous reading of 6.0% to 6.4%, exceeding the market forecast at 5.9%. The high inflation risk sparked hopes upon the rate hike from the Federal Reserve during the FOMC meeting next week. Tightening Monetary Policy would likely to diminish the money circulation for the US Dollar, which spurring bullish momentum on the pair. Nonetheless, the gains experienced by the US Dollar was limited by the bearish job data. Department of Labor reported that US Initial Jobless Claims came in at 227K, missing the market forecast at 217K. As of writing, the Dollar Index appreciated by 0.56% to 98.52.

In the commodities market, the crude oil price appreciated by 1.52% to $108.30 per barrel as of writing. The crude oil price edged higher amid rising tensions between Russia-Ukraine following Ukraine-Russia talks in Turkey ended with no progress on Ceasefire. On the other hand, the gold price depreciated by 0.07% to $1995.55 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EUR Leader Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) | -0.20% | – | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Jan) | 0.20% | 0.20% | – |

| 21:30 | CAD – Employment Change (Feb) | -200.1K | 160.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after successfully breakout.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0975, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 116.25, 117.50

Support level: 114.60, 113.65

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the lower level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2785, 1.2885

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9345, 0.9420

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 116.80, 127.05

Support level: 106.55, 99.45

GOLD_, H1: Gold price was traded within a range while currently testing the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower.

Resistance level: 1996.85, 2016.70

Support level: 1976.75, 1959.60

100322 Afternoon Session Analysis

10 March 2022 Afternoon Session Analysis

Euro jumped, commodities price beaten down from recent high.

The Euro started rebounding since its recent low, while commodities product are easing from its recent high. Oil prices retreated on Thursday after the United Arab Emirates said it is committed to major producers’ pact to add 400,000 barrels per day of supply monthly, hours after UAE’s ambassador to Washington said his country favored a bigger increase. Euro is benefited amid the backdrop of increasing supply of crude oil, led to easing of oil price and reducing the cost of importing crude oil. It spurred the market optimism toward European economy, prompting market participants to buy Euro. On the other hand, the European Central Bank would likely to make few policy commitments on Thursday in order to offset the impact of Russia’s invasion of Ukraine while combating with inflation rate. Investor should continue to focus the latest updates of European Central Bank’s announcement to gauge the likelihood movement of Euro. As of writing, Euro edged down by 0.18% to 1.1054.

In the commodities market, the crude oil price has slumped by 0.49% to $109.13 per barrel as of writing following UAE committed to add 400,000 barrels of oil per day of supply monthly. Besides, gold price dumped by 0.72% to $1976.88 per ounce amid market optimism toward risk-appetite products following the easing tensions of Russia-Ukraine conflict.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EUR Leader Summit

20:45 EUR ECB Monetary Policy Statement

20:45 EUR ECB Interest Rate Decision (Mar)

21:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Feb) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 215K | 216K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3190. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0975. MACD which illustrated increasing bullish momentum suggest the pair to extend its gain.

Resistance level: 1.1135, 1.1245

Support level: 1.0975, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 116.25, 117.50

Support level: 114.60, 113.65

AUDUSD, Daily: AUDUSD was traded higher following prior rebounded from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.2885, 1.2950

Support level: 1.2785, 1.2705

USDCHF, Daily: USDCHF was traded higher while testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.9280, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after successfully breakout.

Resistance level: 116.80, 127.05

Support level: 107.45, 99.45

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1975.00. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1996.85, 2016.70

Support level: 1975.00, 1959.60

100322 Morning Session Analysis

10 March 2022 Morning Session Analysis

Easing tensions between Russia-Ukraine, safe-haven Dollar dipped.

The Dollar Index which traded against a basket of six major currencies slumped amid positive hopes upon the diplomatic resolution to the Russia-Ukraine, which spurring risk appetite in the global financial market while prompting investors to shift their portfolio toward riskier asset. According to Reuters, Maria Zakharova claimed that the Russia will achieve its goal of ensuring Ukraine’s neutral status and would prefer to achieve consensus through talks instead of war. Besides, she also reiterated that Russian hopes to achieve more significant progress in the next round of talks with Ukraine. Nonetheless, the gains experienced by the US Dollar was limited by the upbeat economic data from US region. According to Bureau of Labor Statistics, US JOLTs Job Opening came in at 11.263M, exceeding the market forecast at 10.925M. As of writing, the Dollar Index depreciated by 1.07% to 98.00.

In the commodities market, the crude oil price rebounded 0.14% to $111.14 per barrel as of writing following the released of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -1.863M, less than the market forecast at -0.657M. On the other hand, the gold price slumped 0.03% to $1991.45 per troy ounces as of writing amid risk-on sentiment in the market following the easing tensions between Russian-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EUR Leader Summit

20:45 EUR ECB Monetary Policy Statement

20:45 EUR ECB Interest Rate Decision (Mar)

21:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Feb) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 215K | 216K | – |

Technical Analysis

DOLLAR_INDX, Weekly: Dollar index was traded lower following prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3190. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0975. MACD which illustrated increasing bullish momentum suggest the pair to extend its gain.

Resistance level: 1.1135, 1.1245

Support level: 1.0975, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 116.25, 117.50

Support level: 114.60, 113.65

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.2885, 1.2950

Support level: 1.2785, 1.2705

USDCHF, Daily: USDCHF was traded higher while testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after successfully breakout.

Resistance level: 116.80, 127.05

Support level: 107.45, 92.30

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1996.85. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1996.85, 2016.70

Support level: 1976.75, 1959.60

090322 Afternoon Session Analysis

9 March 2022 Afternoon Session Analysis

Euro rebounded amid expectation upon latest economic stimulus.

The Euro rebounded on Wednesday ahead of this week’s central bank meeting, while commodity currencies eased from recent peaks as investors reckoned war-driven surges in energy, grains and metals could end up crimping demand in the long run. Such a move could mean stimulus and a step toward a fiscal union, as the European Central Bank was deciding to increase fiscal spending to offset the impact of Russia-Ukraine conflict. However, the overall trend for Euro still remained bearish over the backdrop of rising tensions between Russia and Ukraine. According to Ukraine, the third rounds of talks has only resulted in small progress between Russia-Ukraine. Hence, investors would continue to scrutinize the latest updates with regards of tensions between Russia-Ukraine to receive further trading signal. As of writing, EUR/USD appreciated by 0.23% to 1.0924.

In the commodities market, the crude oil price slumped 0.05% to $125.40 per barrel as of writing over the backdrop of bearish inventory data. According to American Petroleum Institute, US API Weekly Crude Oil Stock came in at 2.811M, higher than market forecast at -0.833M. On the other hand, the gold price appreciated by 0.22% to $2055.05 per troy ounces as of writing as investors enter gold market in order to hedge against inflation risk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – JOLTs Job Openings (Jan) | 10.925M | 10.925M | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -2.597M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 98.85. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 100.25.

Resistance level: 100.25, 101.20

Support level: 98.85, 97.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3095. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0945. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0945, 1.1075

Support level: 1.0820, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 115.70, 116.25

Support level: 114.60, 113.65

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7410. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2885. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2885, 1.2950

Support level: 1.2785, 1.2705

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9345.

Resistance level: 0.9345, 0.9420

Support level: 0.9270, 0.9175

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from lower levels. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower amid technical correction.

Resistance level: 128.40, 132.55

Support level: 122.80, 115.85

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2067.25. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2067.25, 2181.20

Support level: 1996.85, 1881.35

090322 Morning Session Analysis

9 March 2022 Morning Session Analysis

Stagflation risk lingers, safe-haven Dollar surged.

The Dollar Index which traded against a basket of six major currencies continue to extend its gain amid risk-off sentiment in the market, which prompting investors to purchase safe-haven Dollar. Currently, market participants remained concerns that the rising commodities price triggered by Russian-Ukraine war would likely to spur stagflation risk in future, dialed down the market optimism toward the economic progression in the United States. According to Reuters, US President Joe Biden announced a ban on Russian oil and other energy imports from Russia on Tuesday in retaliation for the invasion of Ukraine. As for now, investors would continue to focus on the FOMC meeting next week to gauge the likelihood movement for the US Dollar. The Dollar Index appreciated by 0.05% to 99.10.

In the commodities market, the crude oil price surged 0.46% to $126.45 per barrel as of writing. The oil market continues to edge higher amid the implementation of sanction would disrupt the oil supply in future. On the other hand, the gold price appreciated by 0.05% to $2,048.45 per troy ounces as of writing as investors shifted their portfolio toward safe-haven gold to hedge against the high inflation risk in future.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – JOLTs Job Openings (Jan) | 10.925M | 10.925M | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -2.597M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 98.85. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 100.25.

Resistance level: 100.25, 101.20

Support level: 98.85, 97.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3095. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0945. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0945, 1.1075

Support level: 1.0820, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7410. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2885. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.2885, 1.2950

Support level: 1.2785, 1.2705

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9345.

Resistance level: 0.9345, 0.9420

Support level: 0.9270, 0.9175

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from lower levels. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower amid technical correction.

Resistance level: 127.30, 132.55

Support level: 122.80, 115.85

GOLD_, H1: Gold price was traded higher following prior rebound from lower levels. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 2055.70, 2070.75

Support level: 2025.95, 2001.45

080322 Afternoon Session Analysis

08 March 2022 Afternoon Session Analysis

Euro slumped amid supply disruption spurred stagflation risk.

The Euro extends its losses over the backdrop of intensified tensions between Russia-Ukraine continue to spark negative prospect toward the economic in European region. Market participants continue to speculate that the global supply shortage due to the implementation of sanction would continue to push up the commodities prices in future, leading to stagflation risk for the European countries. Nonetheless, the European Central Bank would be meeting on Thursday to discuss about the monetary policy plan. As for now investors would continue to focus on the monetary policy meeting progress to receive further trading signal. On the other hand, the Japanese Yen slumped over the backdrop of bearish economic data. According to Ministry of Finance, Japan Current Account notched down significantly from the previous reading of -0.371T to -1.189T, missing the market forecast at –0.880T. As of writing, the EUR/USD depreciated by 0.03% to 1.0880 while USD/JPY surged 0.14% to 115.45.

In the commodities market, the crude oil price depreciated by 1.26% to $120.20 per barrel as of writing amid technical correction following it reached recent high. On the other hand, the gold price depreciated by 0.58% to $1986.40 per troy ounces as of writing amid strengthening US Dollar with rate hike expectation from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to extend its gains toward resistance level at 100.25.

Resistance level: 100.25, 101.20

Support level: 98.85, 97.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3095. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0945, 1.1075

Support level: 1.0820, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 115.65.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7410. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses towards support level at 0.7285.

Resistance level: 0.7410, 0.7525

Support level: 0.7285, 0.7180

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from lower levels. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2805. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.2805, 1.2875

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower amid technical correction.

Resistance level: 122.80, 132.55

Support level: 115.85, 106.20

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1979.40. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2001.45, 2025.95

Support level: 1979.40, 1967.90

080322 Morning Session Analysis

8 March 2022 Morning Session Analysis

Equity market down, safe-haven US Dollar appreciated.

The Dollar Index which traded against a basket of six major currencies surged on yesterday over the backdrop of diminishing risk appetite in the global financial market, which stoked a shift in sentiment toward safe-haven asset such as US Dollar. Yesterday, the US equity market slumped significantly on the heightening Russia-Ukraine conflict as investors worry that such tensions would likely to spur significantly inflation risk in future, which dialing down the market optimism toward the profit margin on the companies. Besides, US Dollar extends its gains amid hawkish expectation from Federal Reserve. Recently, spiking inflation would increase the odds for Fed to implement a rate hike policy in short-term basis to combat the inflation risk. Tightening monetary policy would reduce the money supply for the US Dollar market, spurring further bullish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.60% to 99.25.

In the commodities market, the crude oil price extends its gains by 0.19% to 121.81 per barrel as of writing. The oil market edged higher as market participant speculated that the implementation of sanction from the West countries to Russia would continue to disrupt the crude oil supply in future. On the other hand, the gold price appreciated by 0.02% to $1998.05 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 100.25, 101.20

Support level: 98.85, 97.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3095. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0985, 1.1065

Support level: 1.0860, 1.0770

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 115.65.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7410. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses towards support level at 0.7285.

Resistance level: 0.7410, 0.7525

Support level: 0.7285, 0.7180

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2805. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.2805, 1.2875

Support level: 1.2805, 1.2705

USDCHF, Daily: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower amid technical correction.

Resistance level: 122.80, 132.55

Support level: 115.85, 106.20

GOLD_, H1: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 2001.45, 2025.95

Support level: 1967.90, 1946.30

070322 Afternoon Session Analysis

07 March 2022 Afternoon Session Analysis

US Dollar surged amid upbeat job data.

The Dollar Index which traded against a basket of six major currencies received significant bullish momentum over the backdrop of upbeat economic data last week, spurring hopes upon the rate hike from Federal Reserve in future. According to Bureau of Labor Statistics, US Unemployment rate notched down from the previous reading of 4.0% to 3.8%, better than the market forecast at 3.9%. Meanwhile, US Nonfarm Payrolls increased from the preliminary reading of 481K to 678K, which exceeding the market forecast at 400K. As both crucial jobs data from US region fared better than expectation, which dialled up the market optimism toward the economic progression in the United States while increasing odds for the implementation of contractionary monetary policy. Such policy as well as the rate hike would likely to reduce the money circulation in the global financial market, increase the appeal for US Dollar. As of writing, the Dollar Index appreciated by 0.43% to 99.10.

In the commodities market, the crude oil price surged 7.75% to 125.40 per barrel as of writing amid rising tensions between Russia-Ukraine would continue to jeopardize the supply for the crude oil in future. On the other hand, the gold price appreciated by 0.96% to $1989.20 per troy ounces as of writing amid risk-off sentiment in the global financial market, spurring bullish momentum on the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 98.95. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 98.95, 100.25

Support level: 97.30, 96.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3190. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3290, 1.3420

Support level: 1.3190, 1.3095

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0820. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0945, 1.1075

Support level: 1.0820, 1.0690

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 114.60. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7410. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7410, 0.7525

Support level: 0.7285, 0.7180

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6895. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2715. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2875

Support level: 1.2715, 1.2635

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 112.80. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 132.55, 145.05

Support level: 112.80, 115.85

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 2001.45. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2001.45, 2025.95

Support level: 1967.90, 1946.30

070322 Morning Session Analysis

7 March 2022 Morning Session Analysis

Safe-haven rises as tension continues.

Safe-haven such as US dollar extended its gains on Monday after market participants reshuffles their portfolio to brace higher tensions in between Russia and Ukraine. Last weekend, White House released a statement stating that Russia’s attack on Ukraine’s nuclear facility is “highly irresponsible” and targeting upon a country’s infrastructure is an act of war crime. On a separate report, UK Ministry of Defense confirmed that high level of Russian air strikes was launched over several Ukrainian cities such as Kharkiv, Mykolaiv and Chernihiv. Russia has pushed forward with their objectives despite two rounds of talks were being held between both countries. In addition, US dollar received subsequent bullish support following the release of upbeat Nonfarm Payrolls report. The latest reading shows that US jobs market continues to progress further, spurring speculation for more frequent interest rate hikes from Federal Reserve. As of writing, the dollar index was up 0.02% to 98.44.

As for commodities, crude oil price rose 8.97% to $126.05 per barrel after US contemplates to ban Russian oil imports. On the other hand, gold price was up 0.99% to $1,986.55 a troy ounce due to tensions in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 98.80, 99.80

Support level: 97.65, 96.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which diminished bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3220, 1.3290

Support level: 1.3150, 1.3070

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 1.0985, 1.1065

Support level: 1.0860, 1.0770

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7425, 0.7470

Support level: 0.7385, 0.7335

NZDUSD, H1: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded hihger in short-term.

Resistance level: 0.6920, 0.6955

Support level: 0.6880, 0.6840

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 127.50, 134.50

Support level: 120.00, 113.55

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1991.50, 2035.00

Support level: 1960.55, 1921.95