040322 Afternoon Session Analysis

04 March 2022 Afternoon Session Analysis

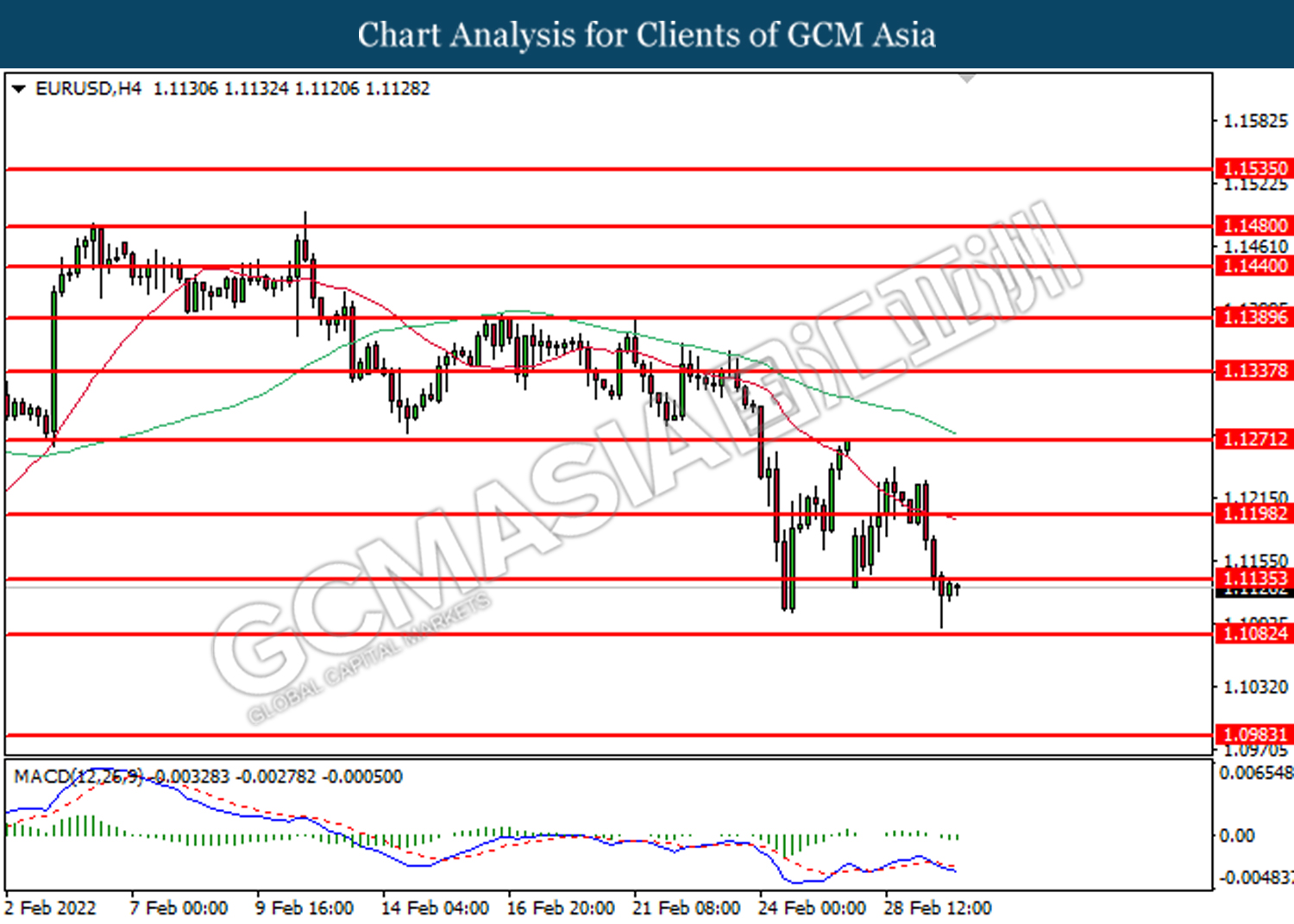

Euro dipped amid rising tensions Russia-Ukraine.

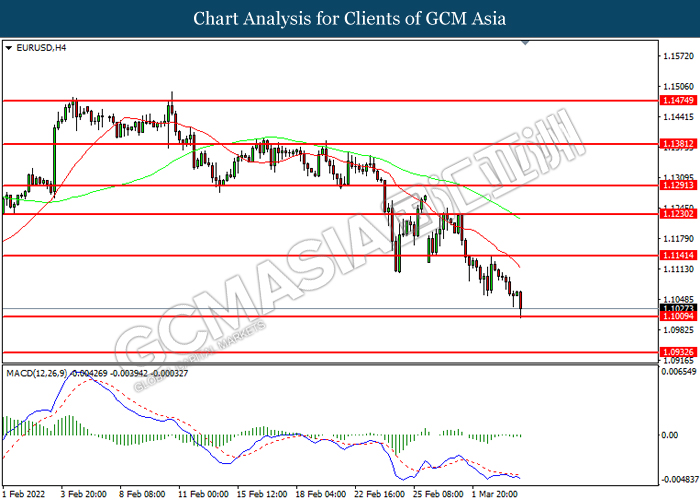

The Euro extend its losses over the backdrop of rising tensions between Ukraine and Russia, which prompting investors to shift their portfolio toward other risk-free currency while dialling down the appeal for Euro. The war in Ukraine and Russia would increase the commodity prices, continued to spur negative prospect toward the European economic growth. According to Reuters, the Ukrainian atomic energy ministry claimed that a generating unit at the Zaporizhzhia nuclear power plant, the largest of its kind in Europe, has been hit during an attack by Russian troops. Nonetheless, investors would continue to scrutinize the latest updates with regards of Russia-Ukraine tensions as well as further economic data to receive further trading signal. As of writing, EUR/USD depreciated by 0.33% to 1.1028.

In the commodities market, the crude oil price appreciated by 1.48% to $111.10 per barrel as of writing. The oil market edged higher amid rising tensions between Russia-Ukraine had continue to spur fears upon the oil supply disruption in future. On the other hand, the gold price surged 0.25% to $1940.65 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Feb) | 56.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 467K | 450K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 4.00% | 3.90% | – |

| 23:00 | CAD – Ivey PMI (Feb) | 50.7 | – | – |

Technical Analysis

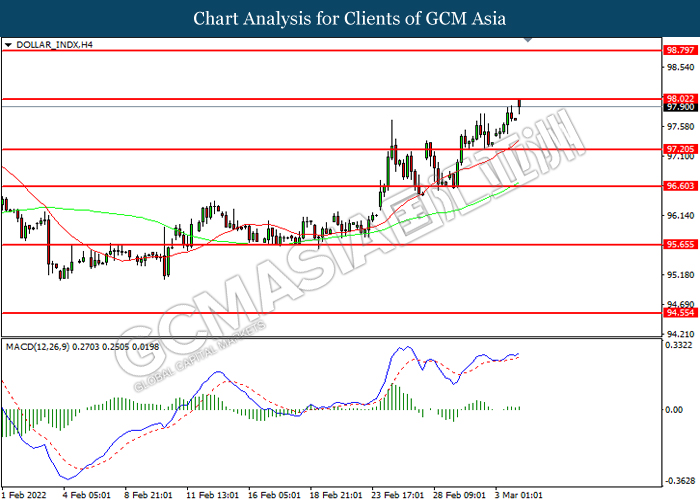

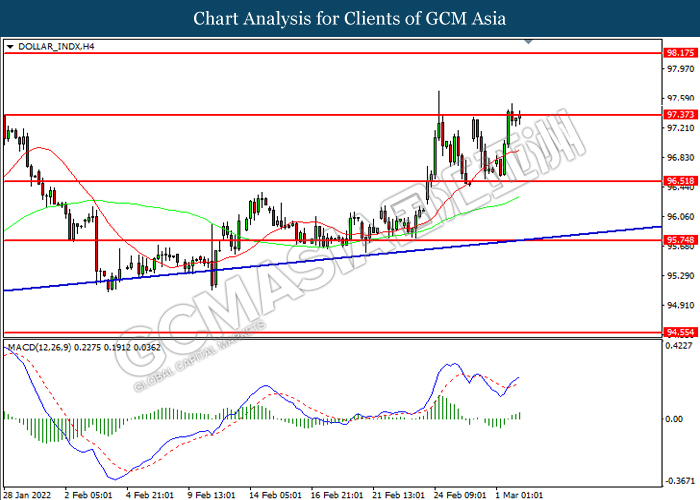

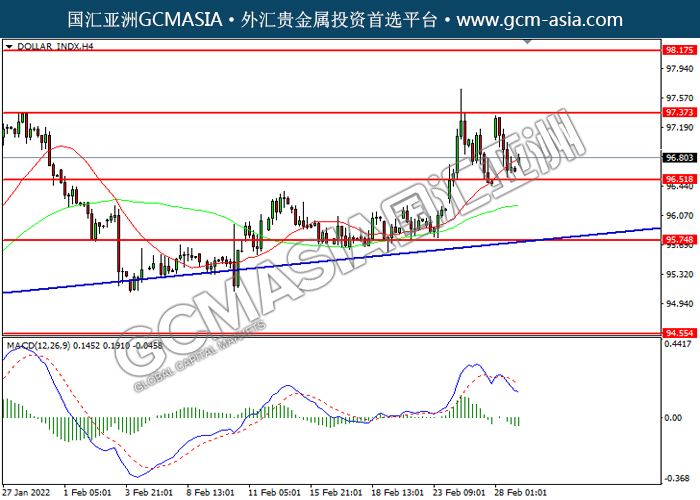

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.45. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 98.00, 98.80

Support level: 97.20, 96.60

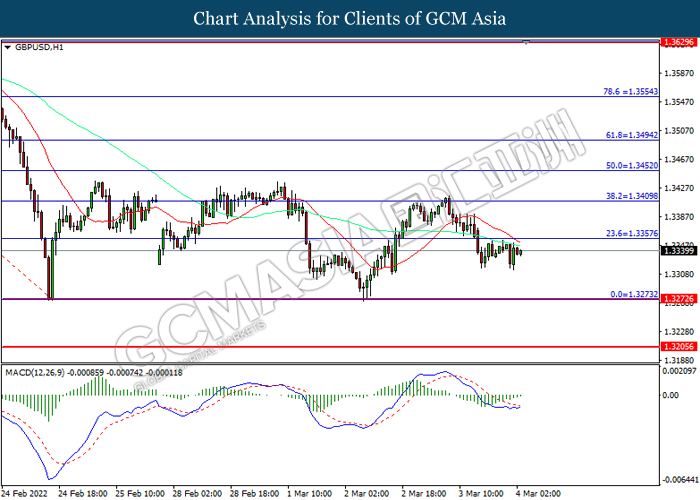

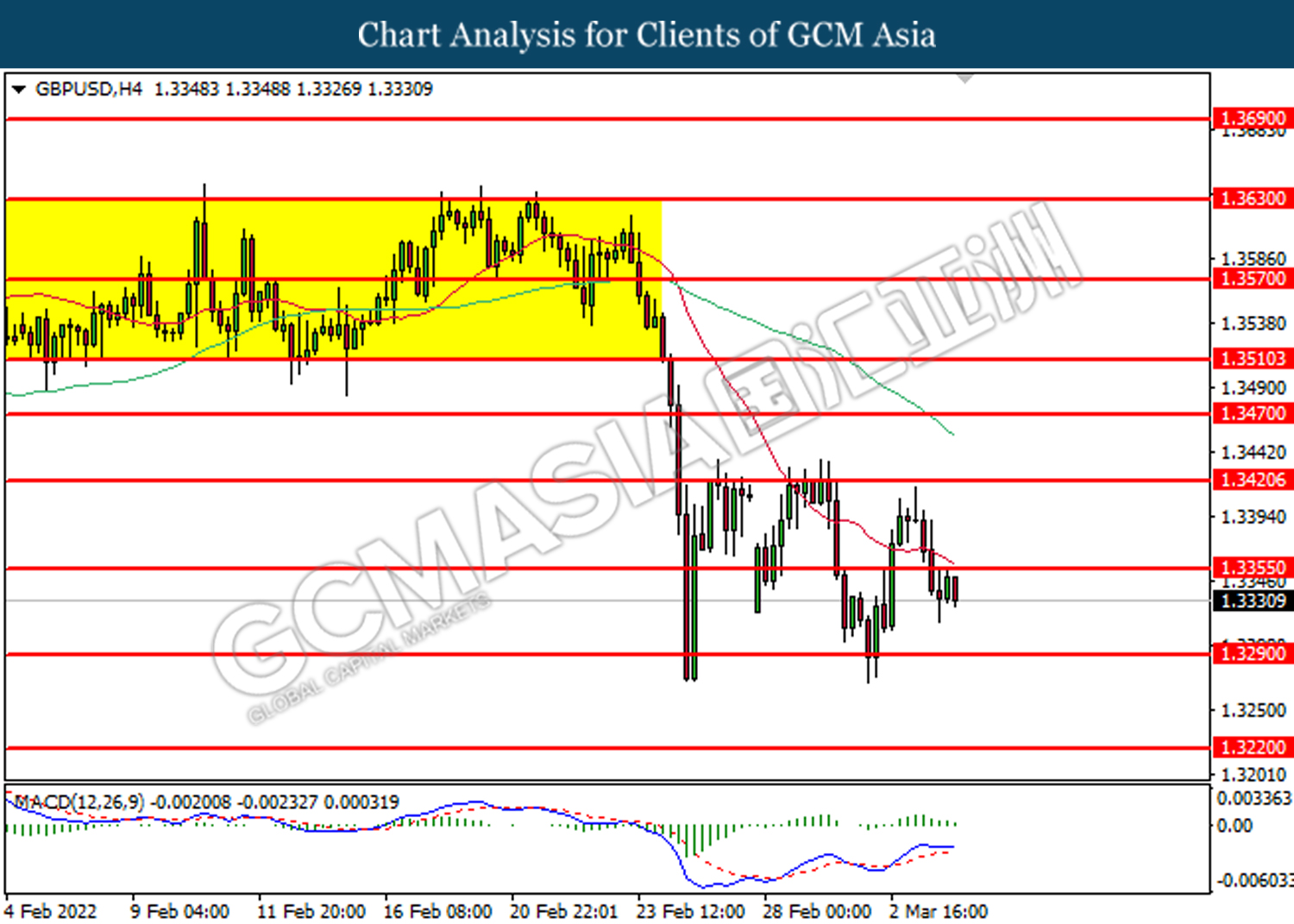

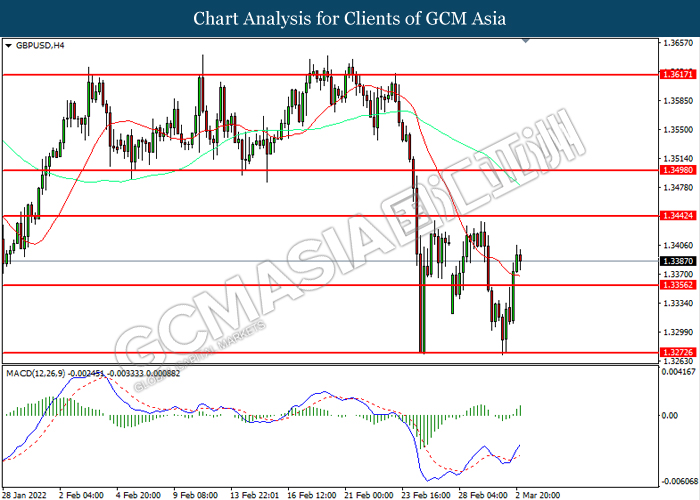

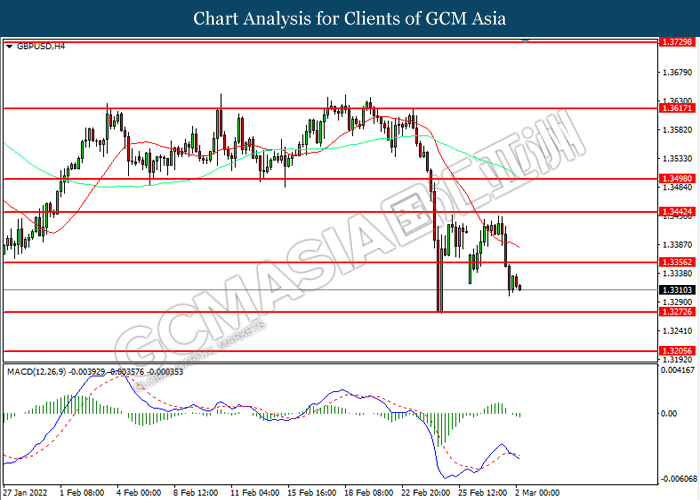

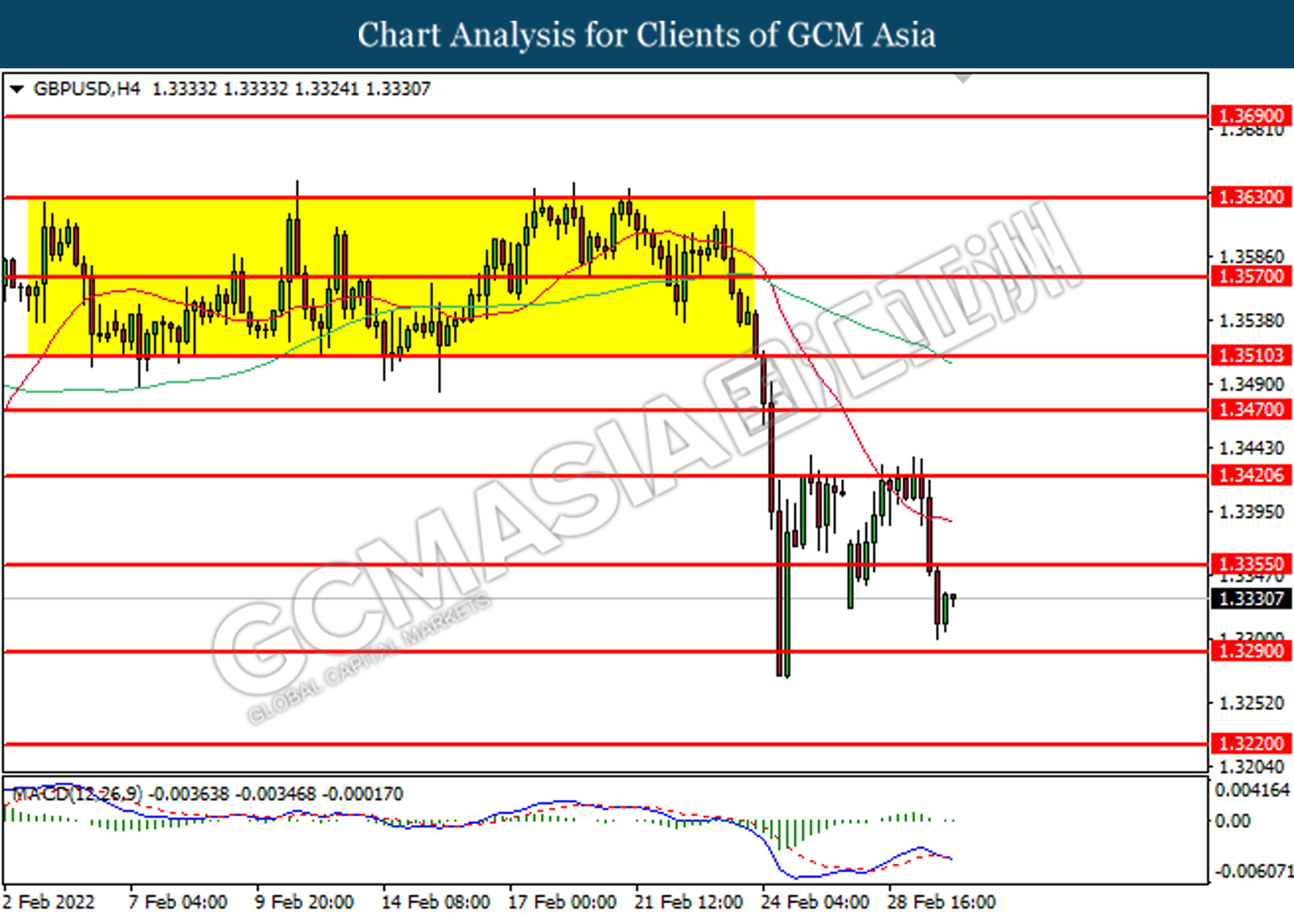

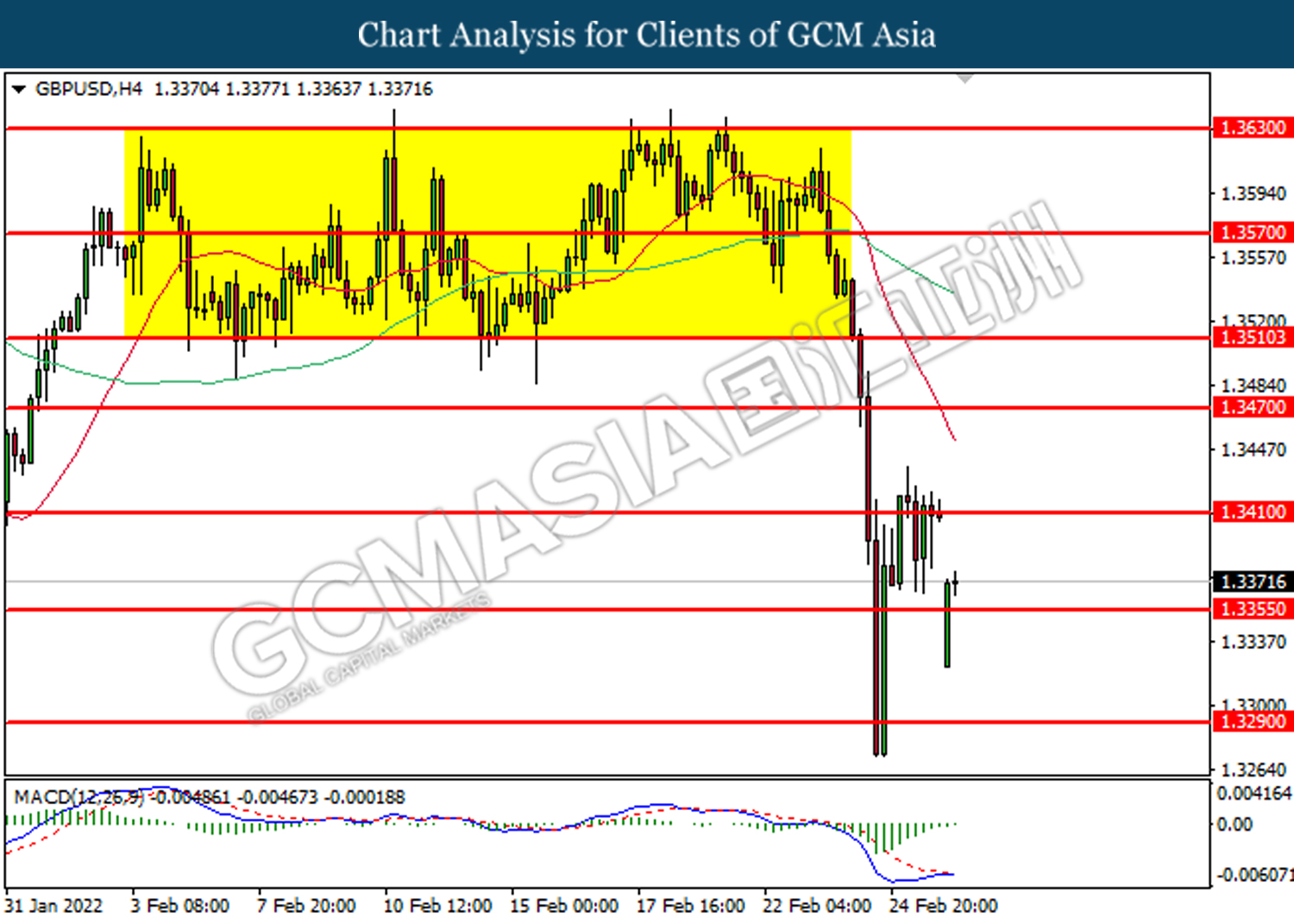

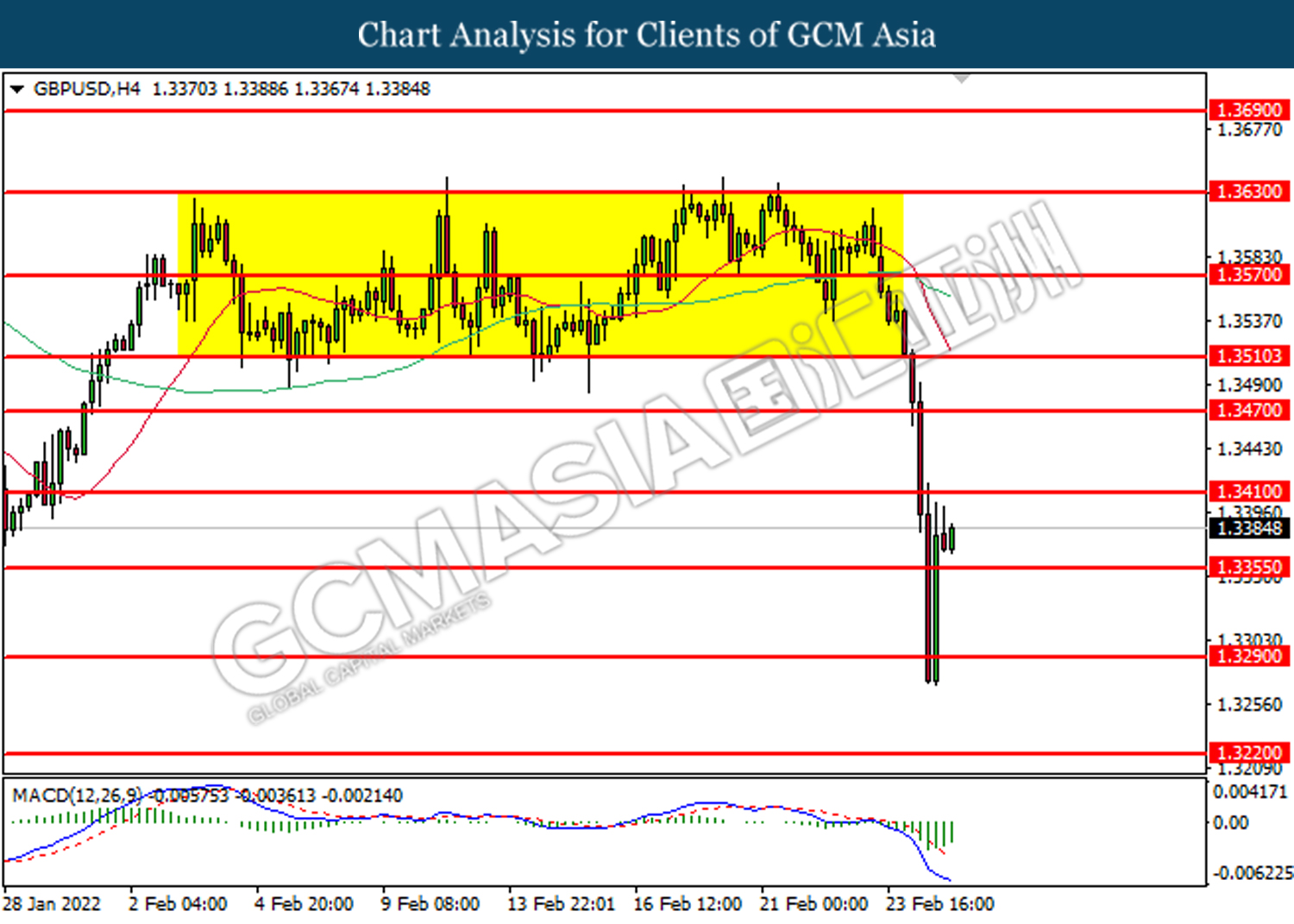

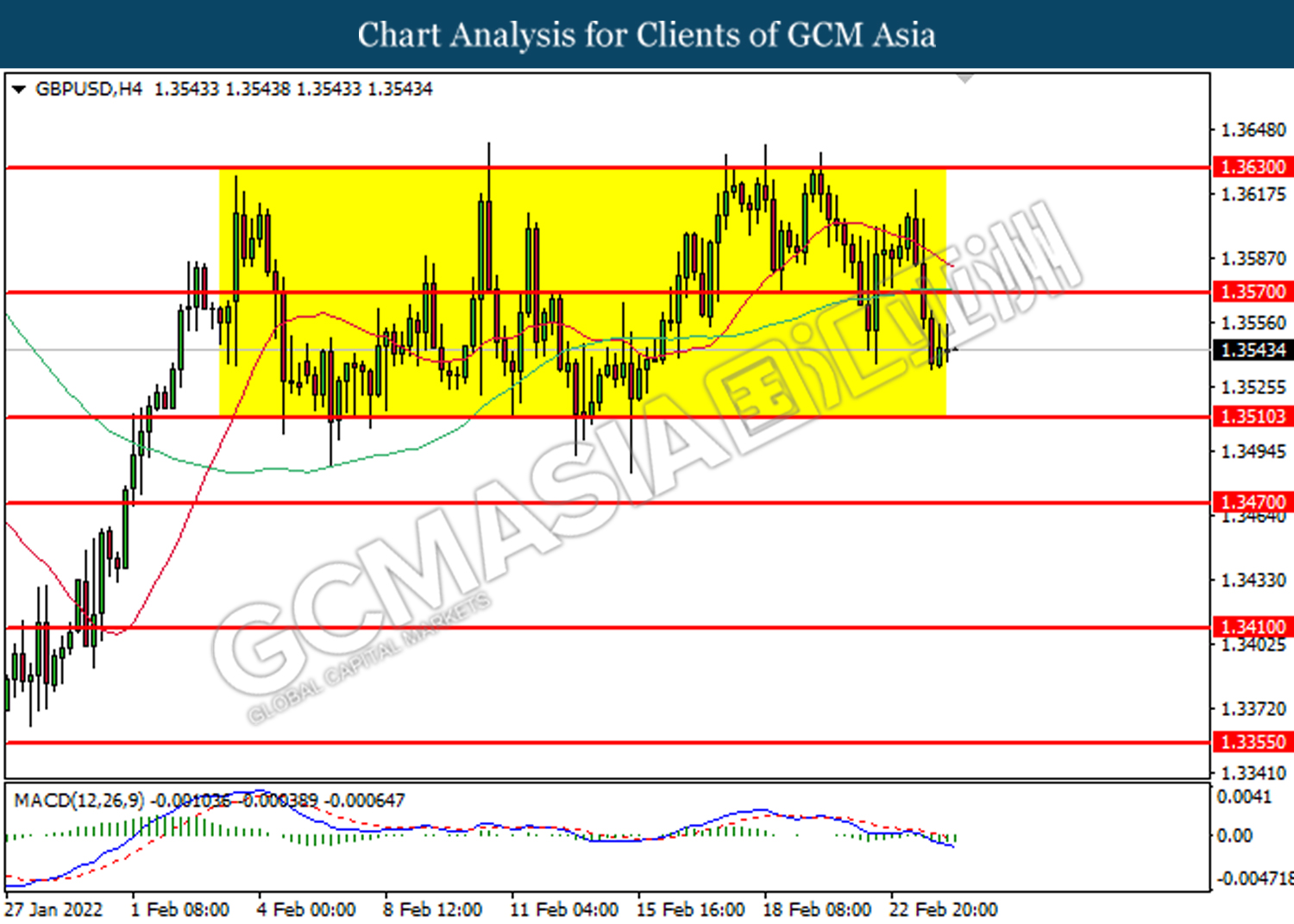

GBPUSD, H1: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3355, 1.3410

Support level: 1.3275, 1.3205

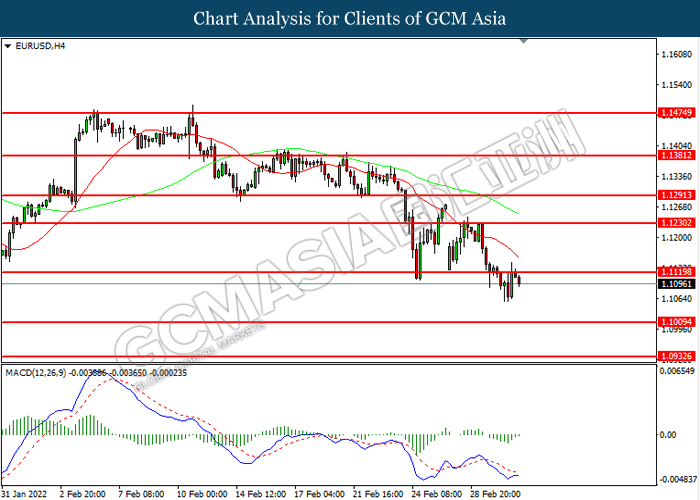

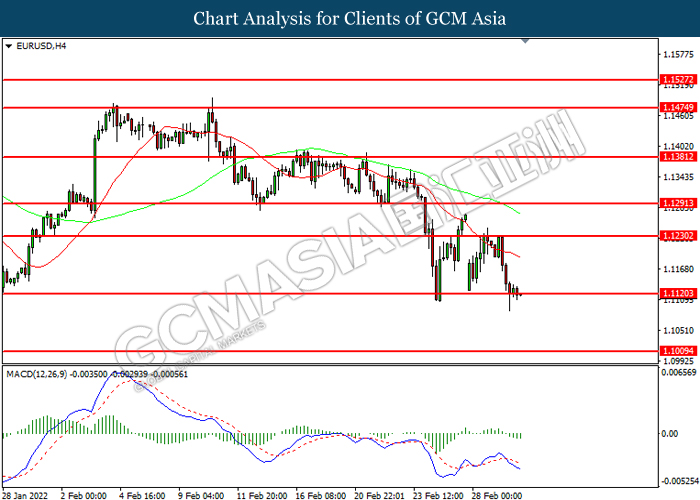

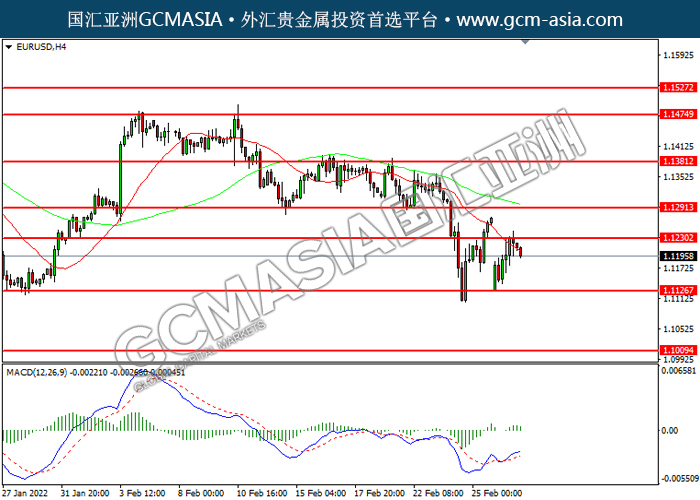

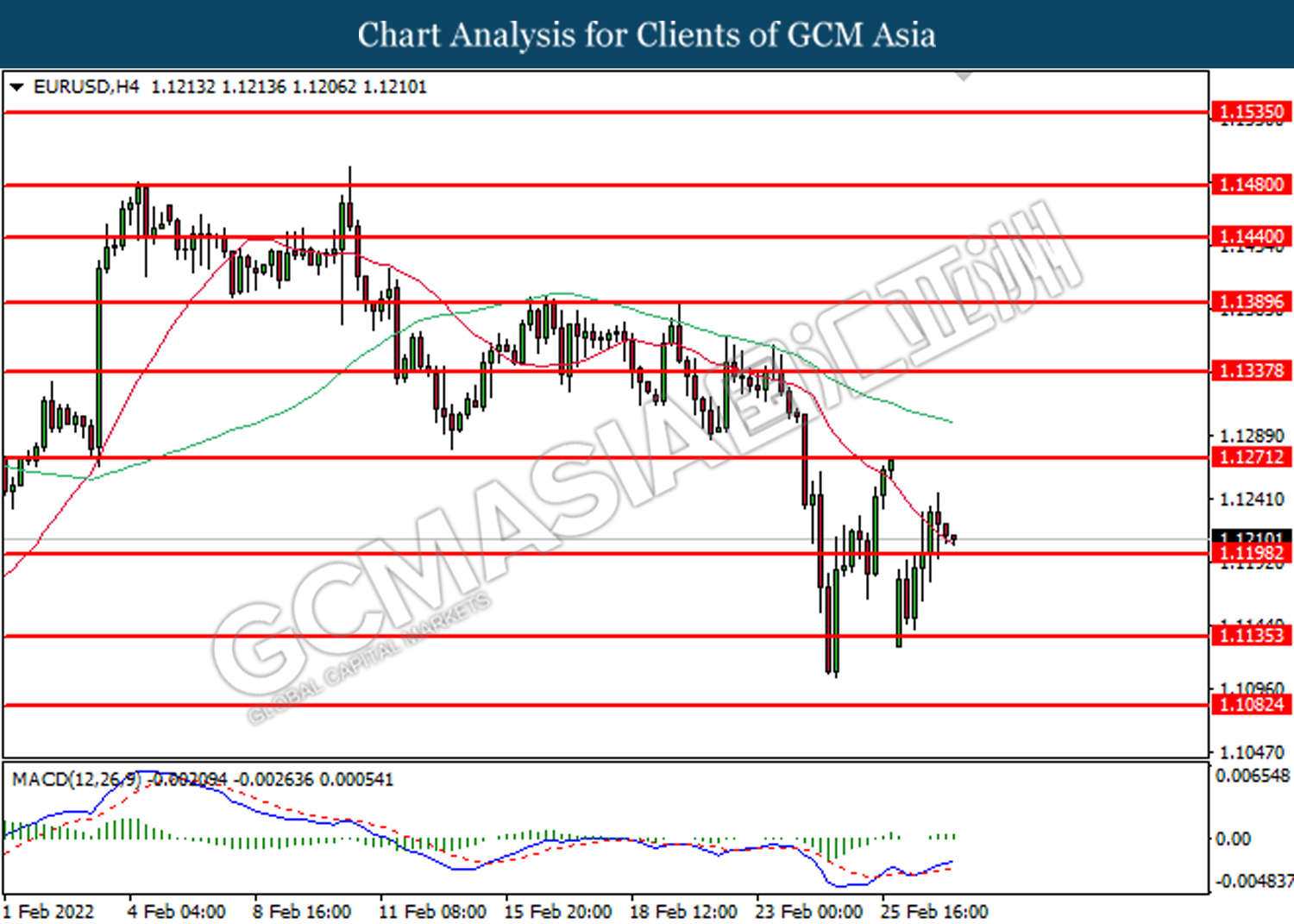

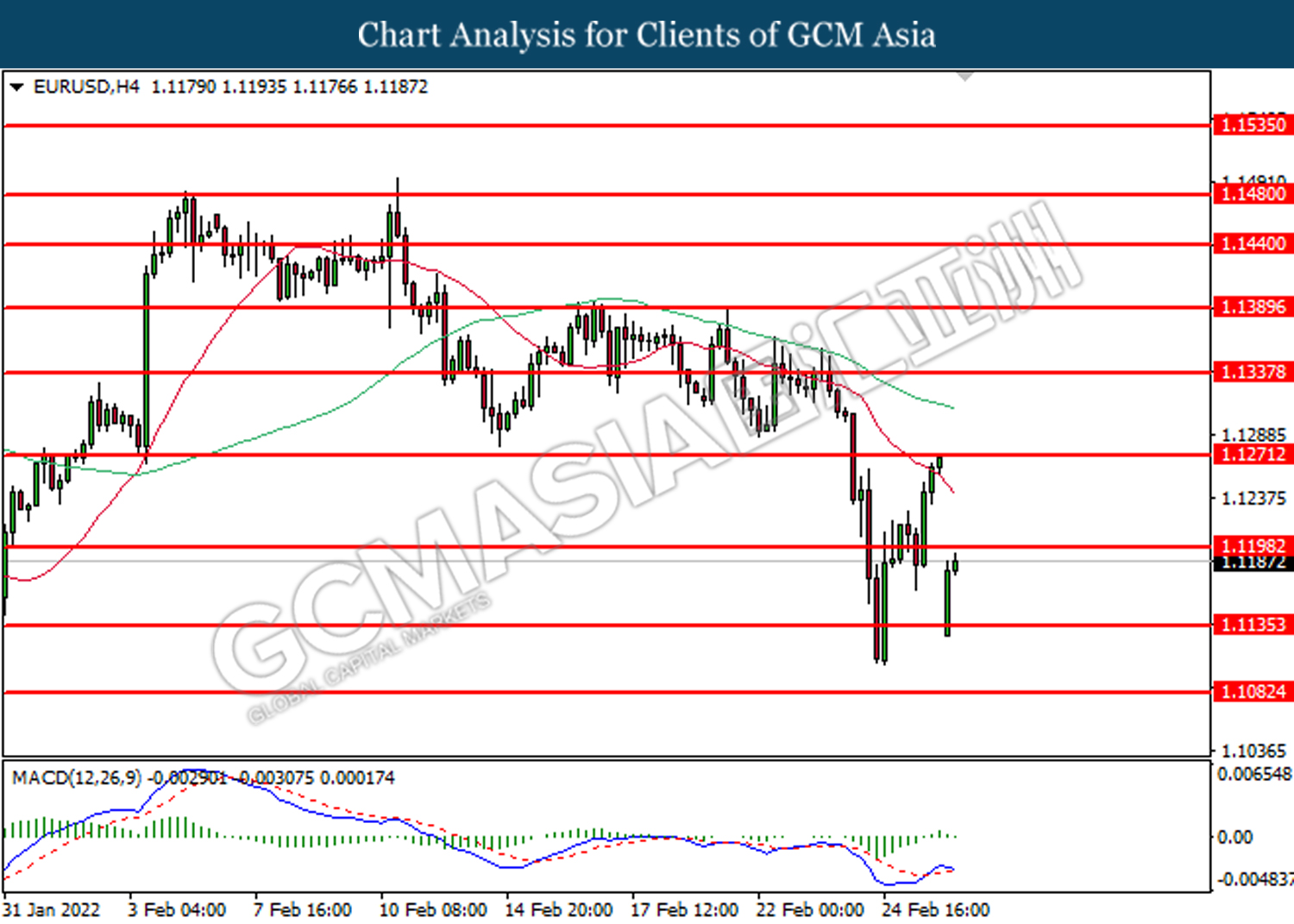

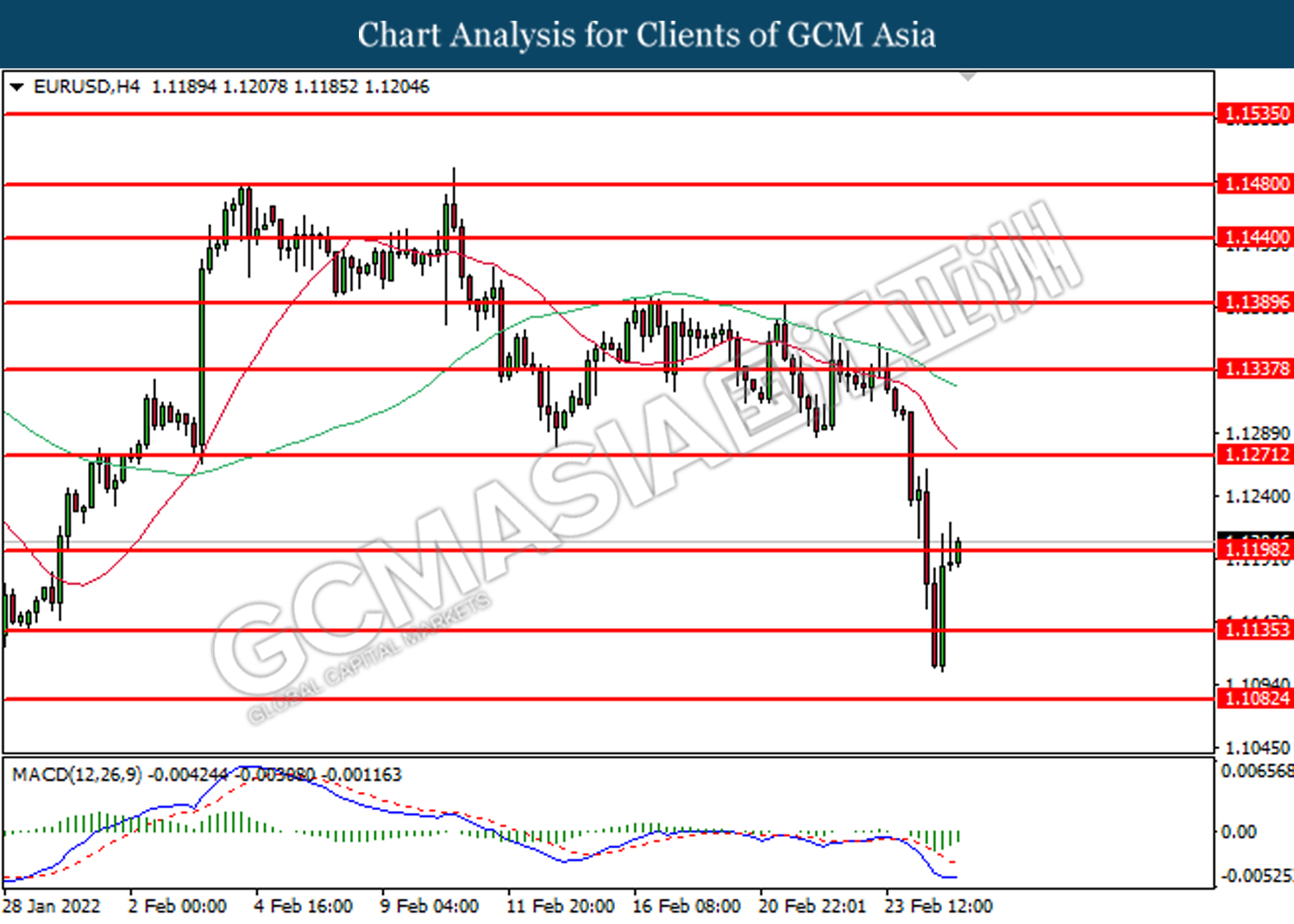

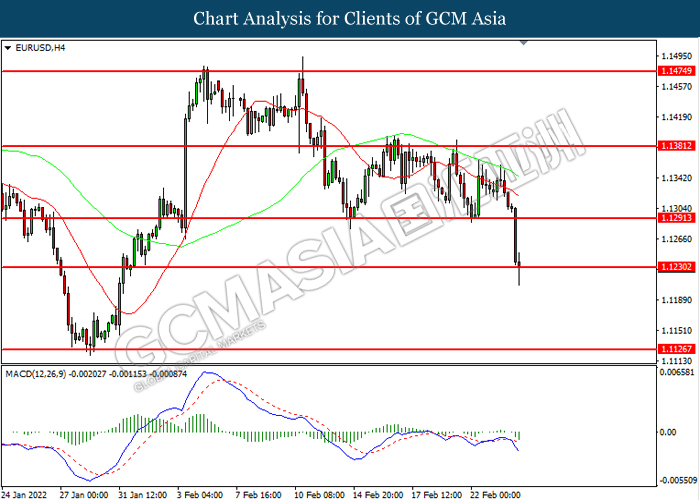

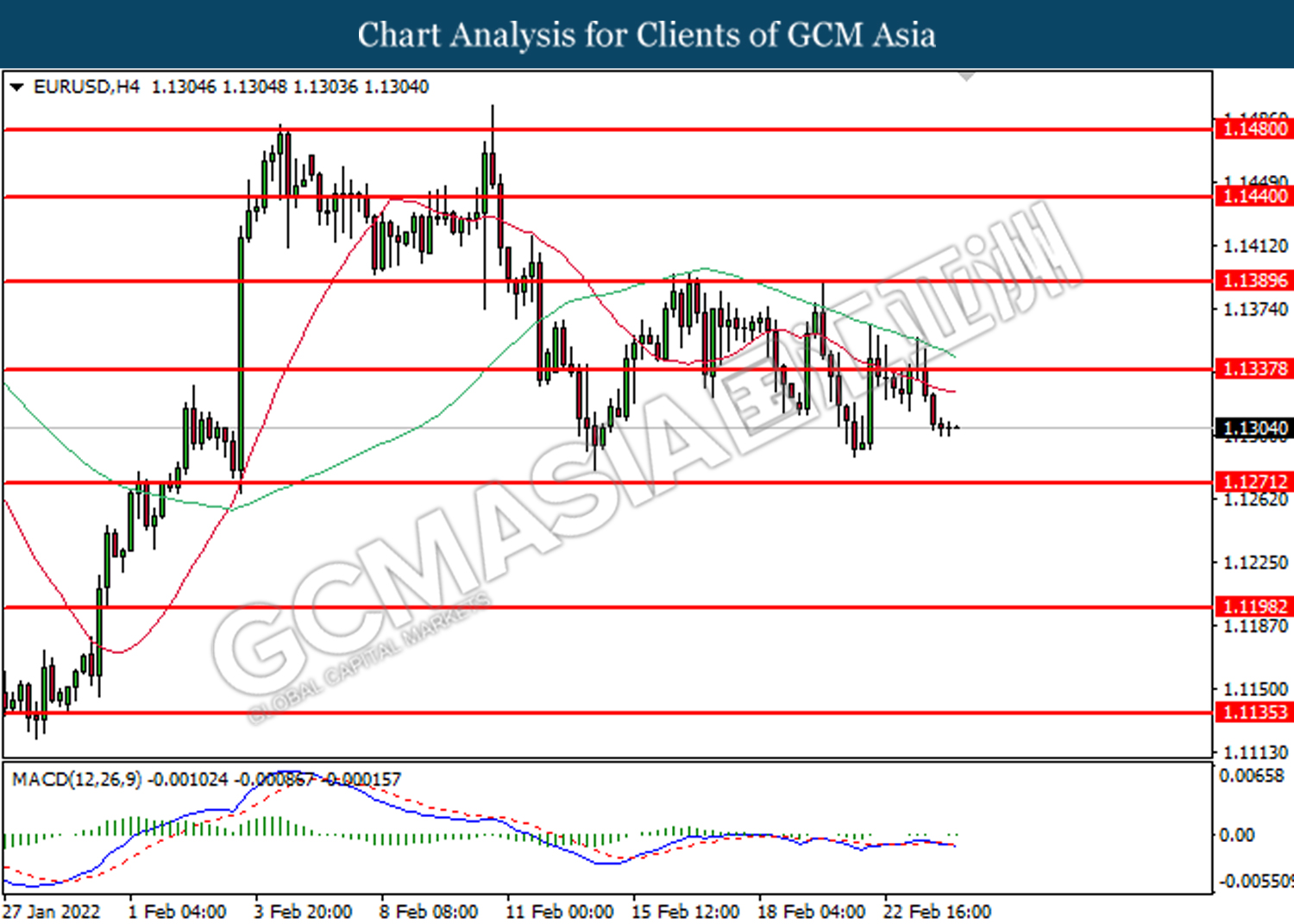

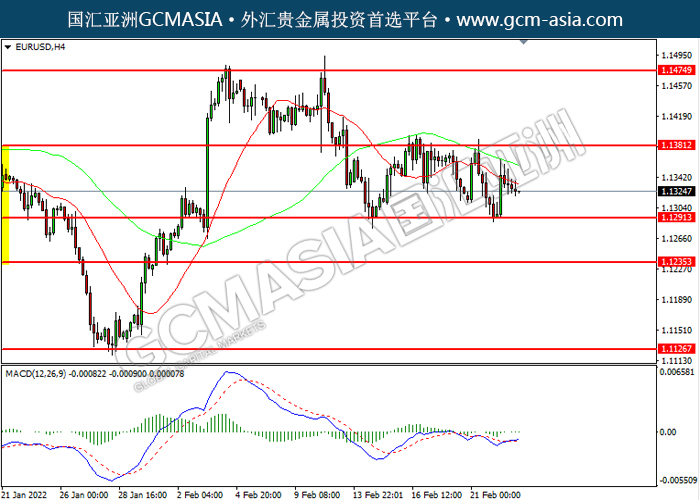

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1140, 1.1230

Support level: 1.1010, 1.0935

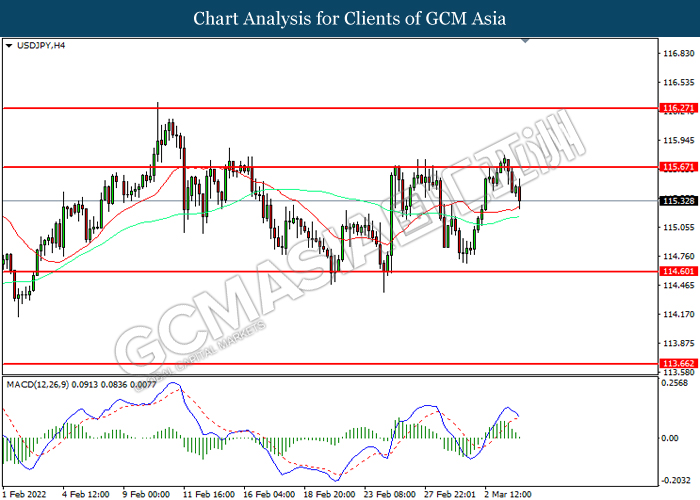

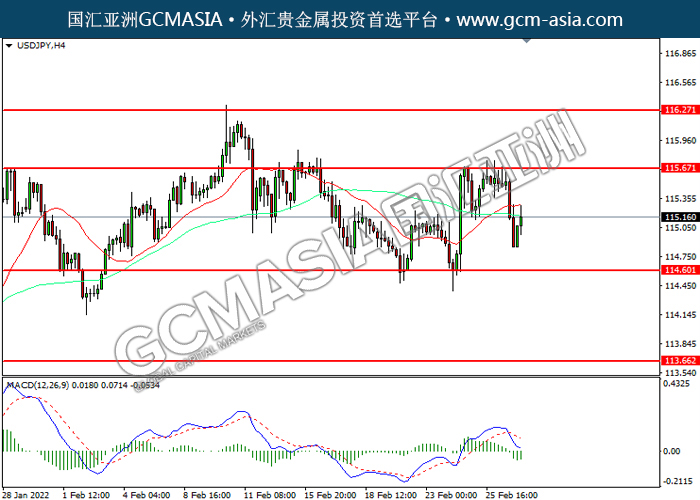

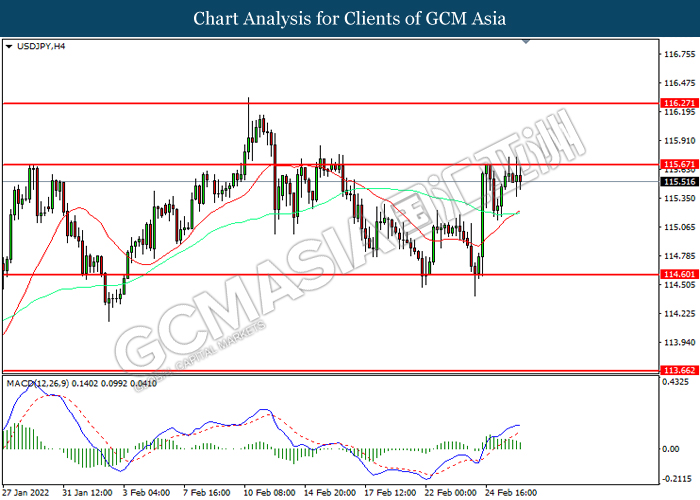

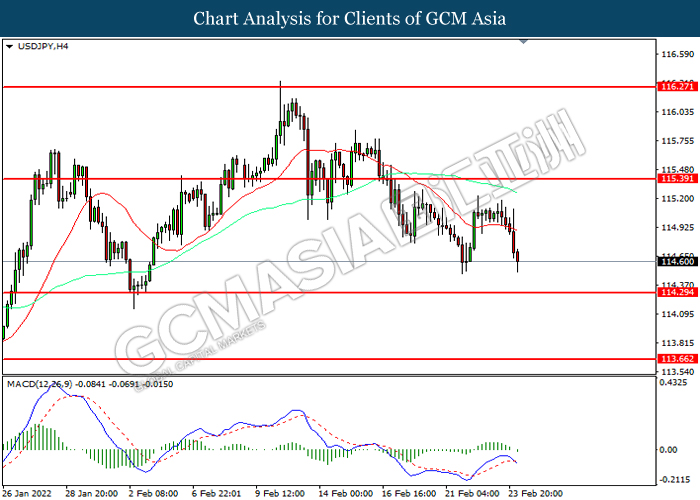

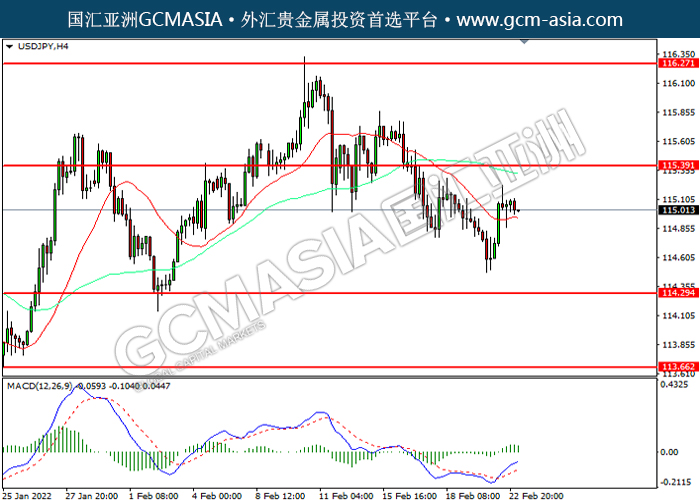

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 115.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 114.60.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

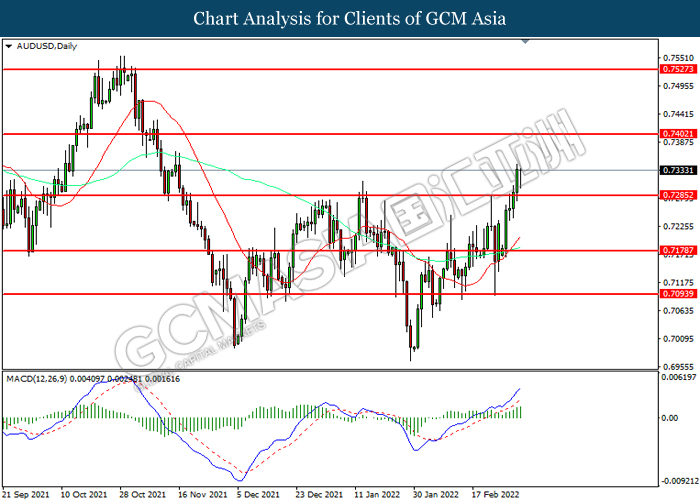

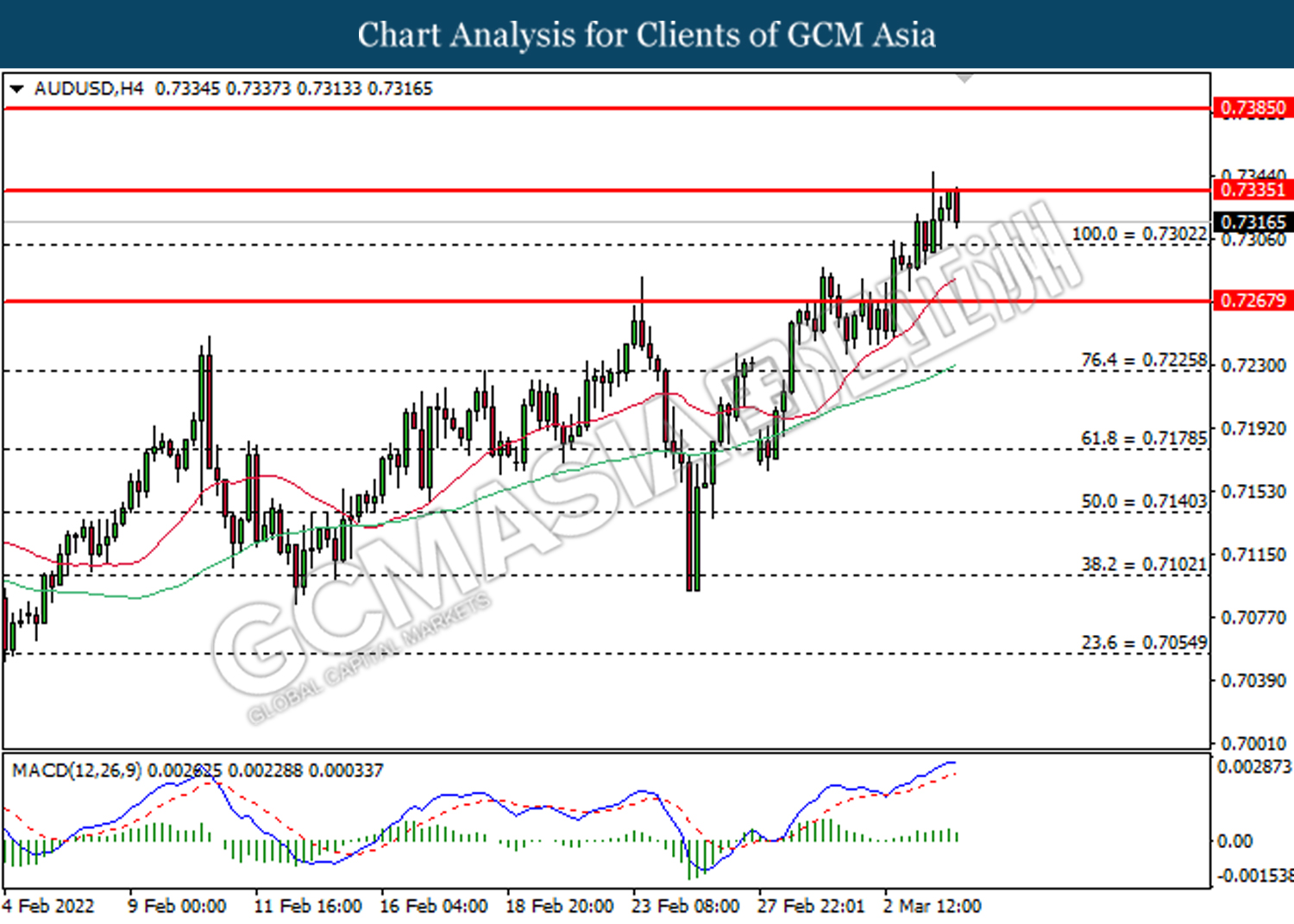

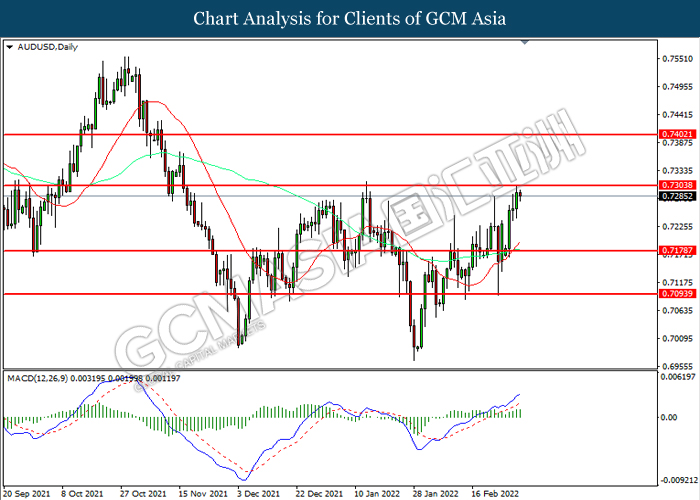

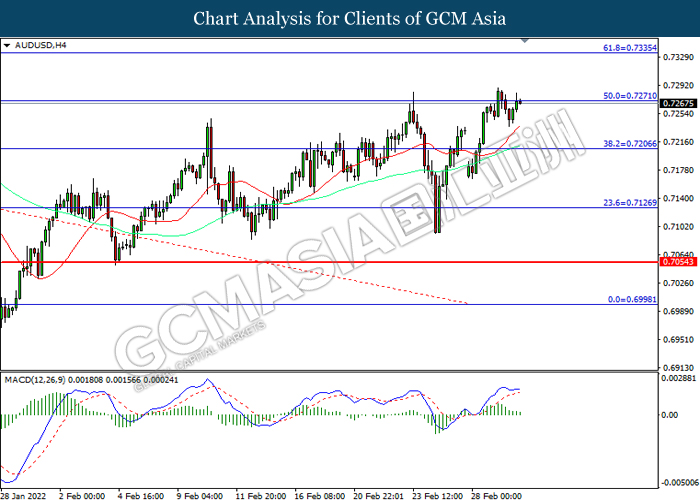

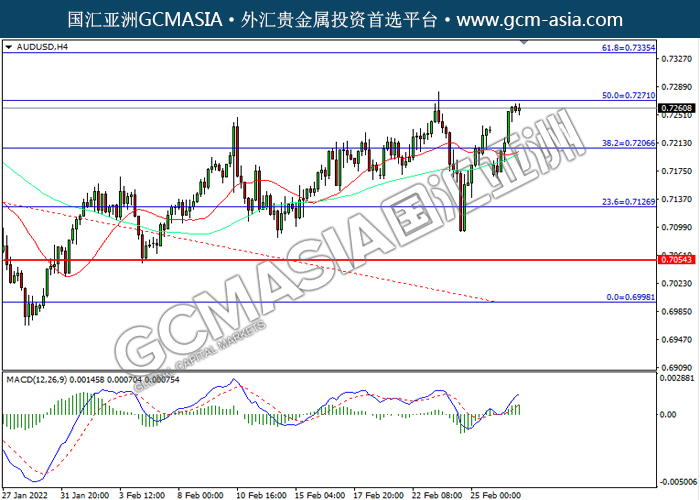

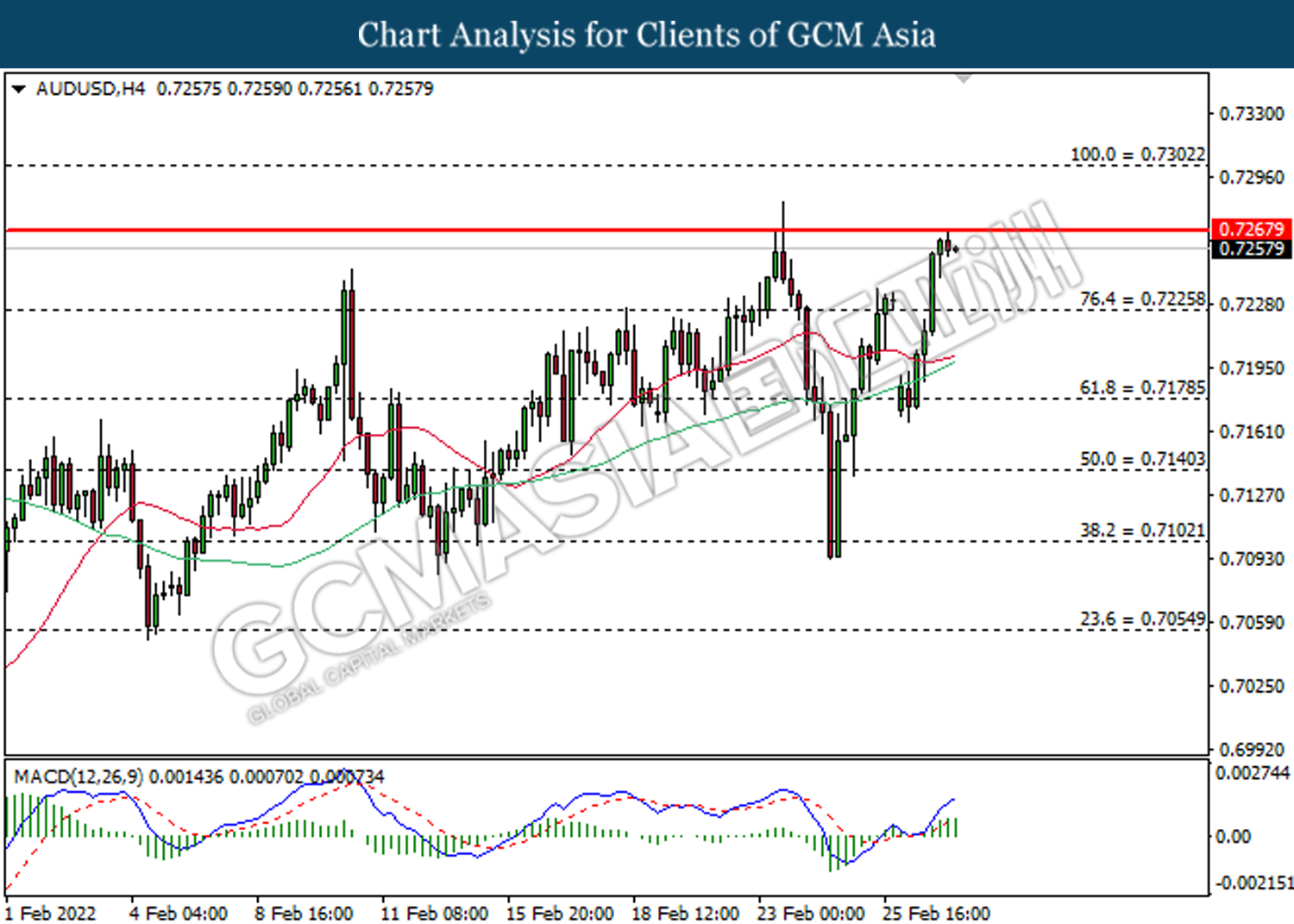

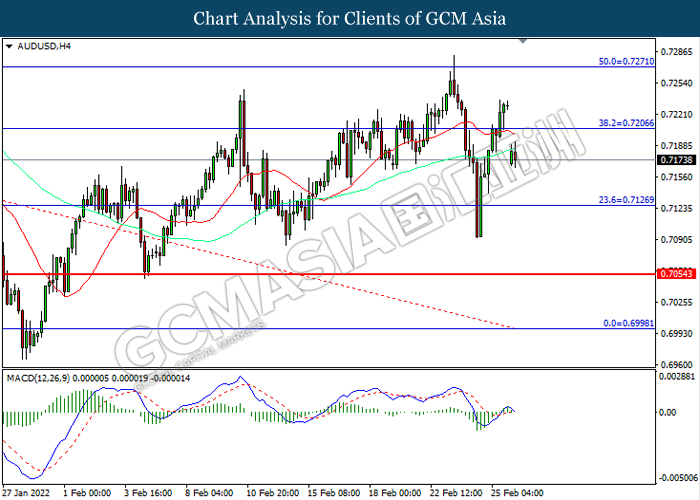

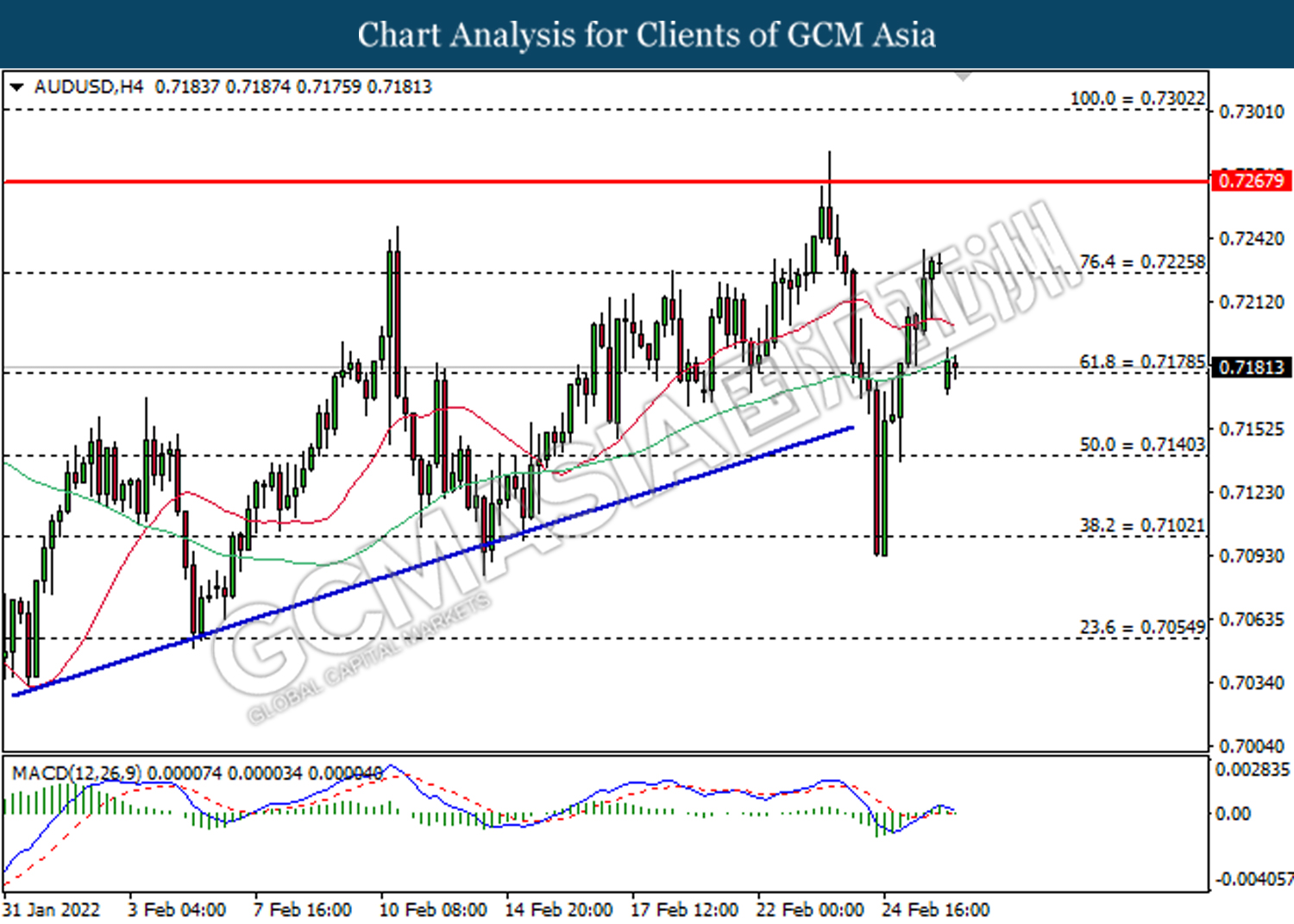

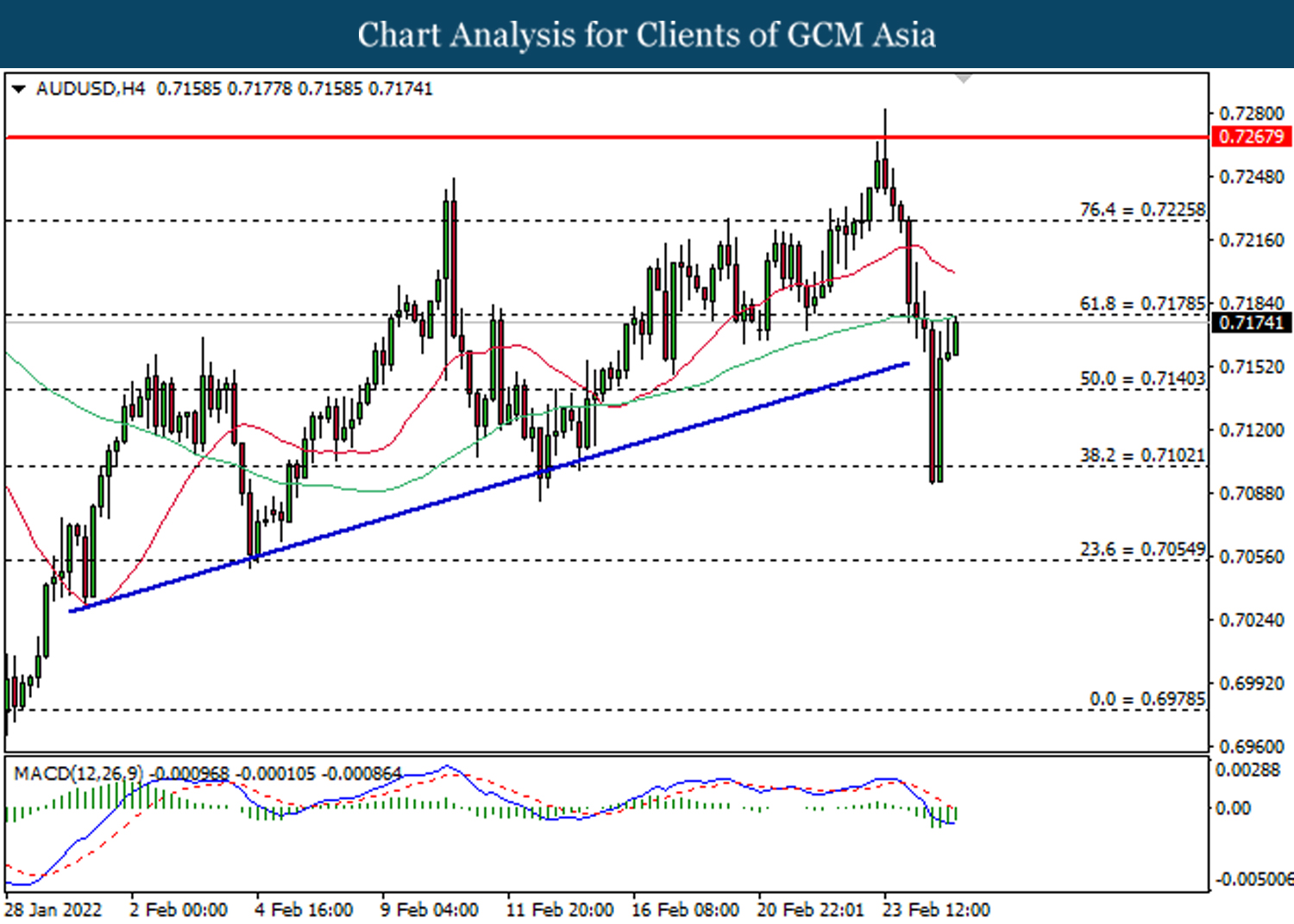

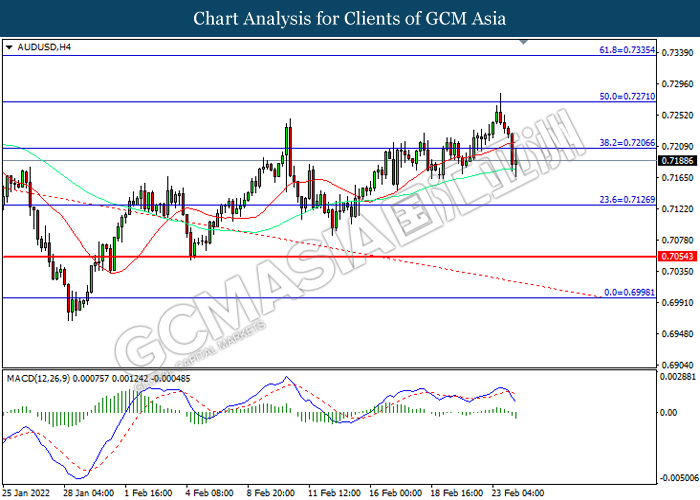

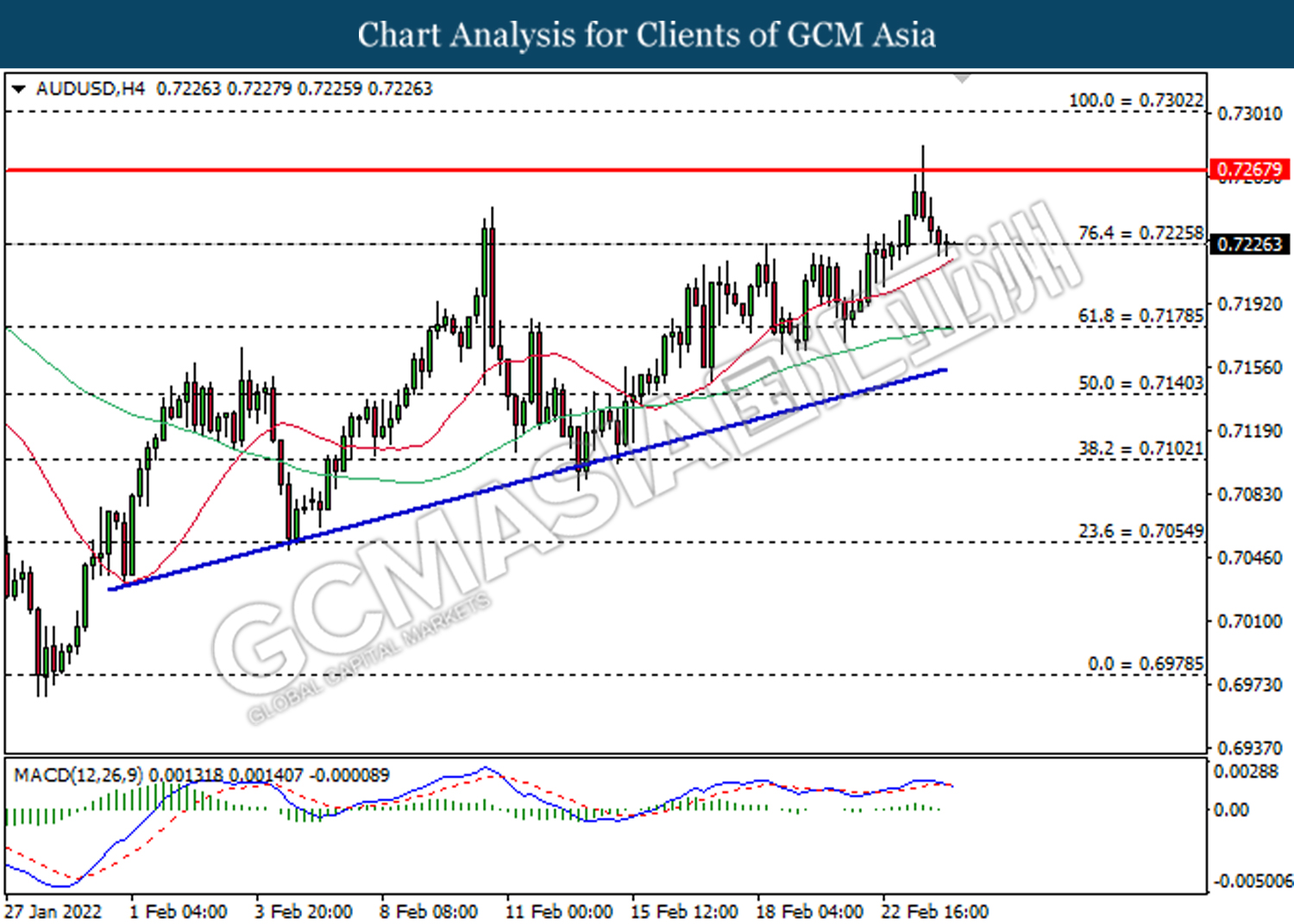

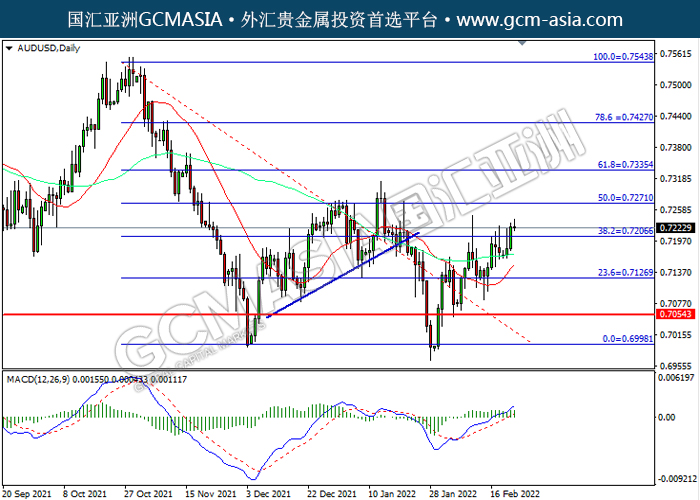

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7285. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7400.

Resistance level: 0.7400, 0.7525

Support level: 0.7285, 0.7180

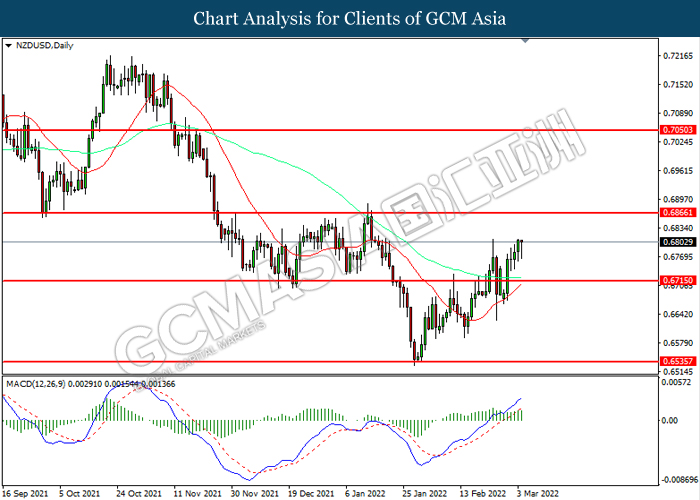

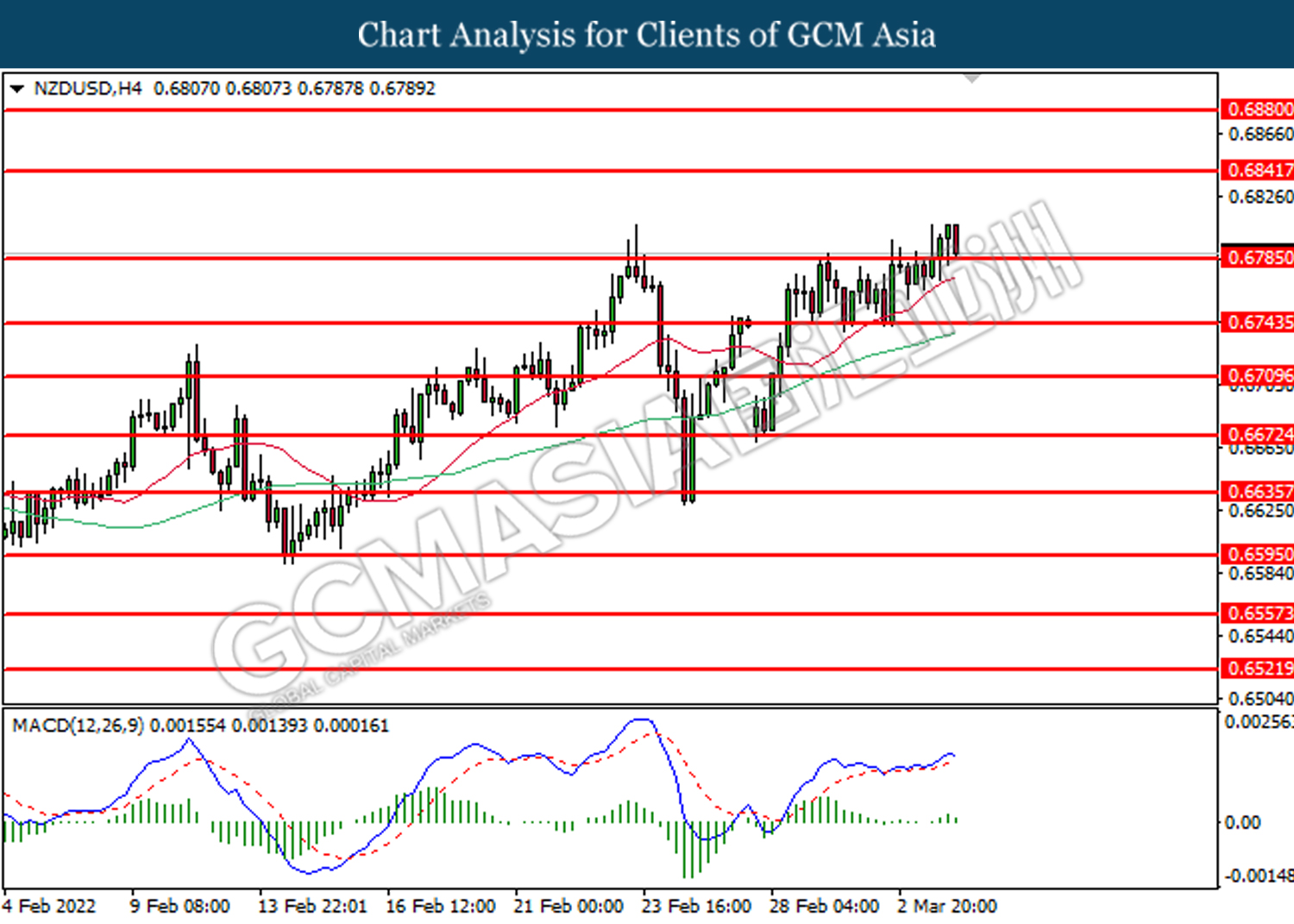

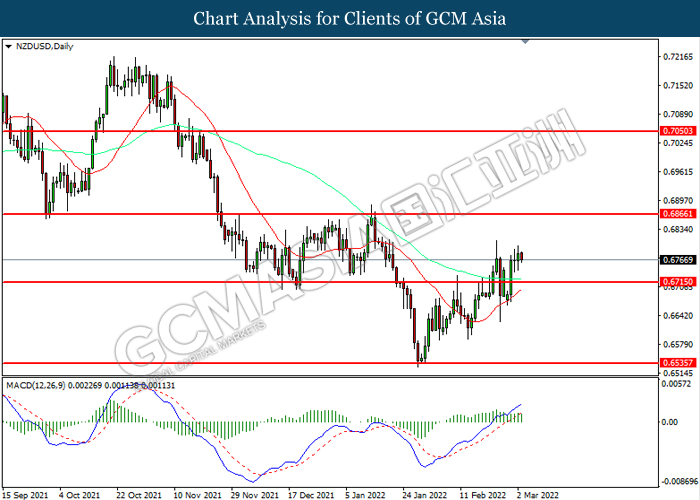

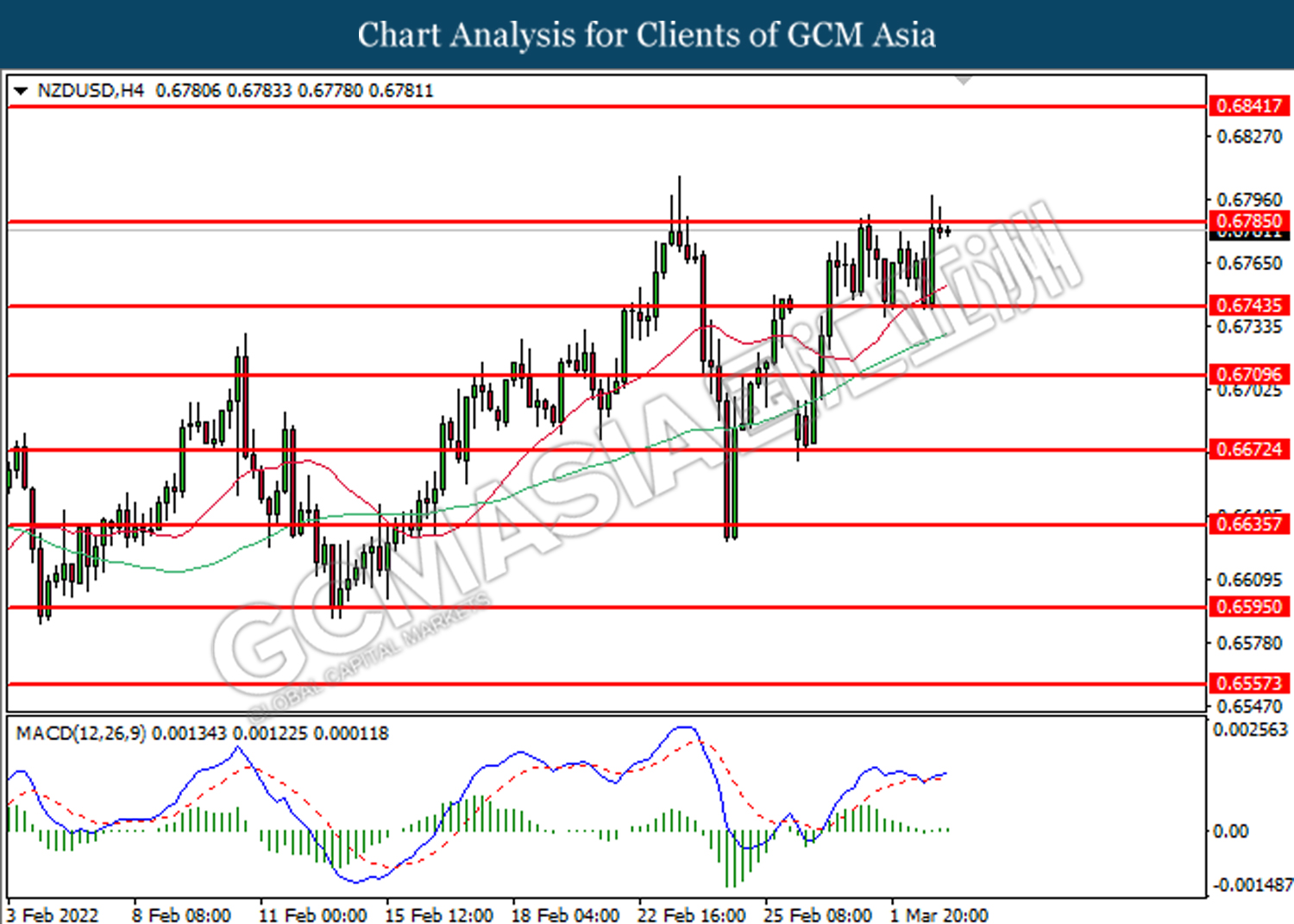

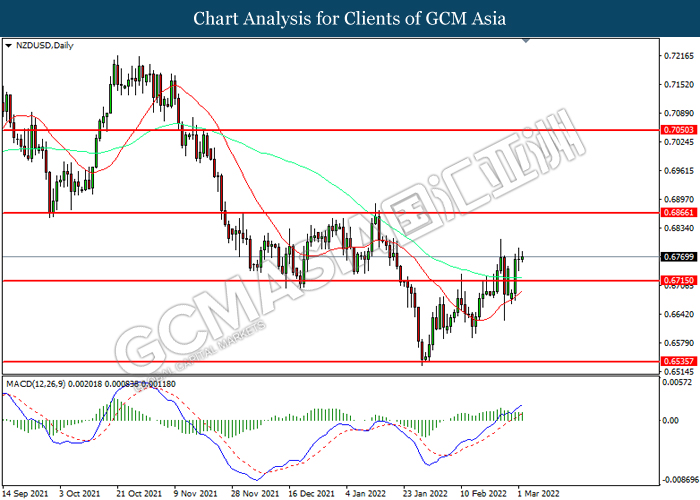

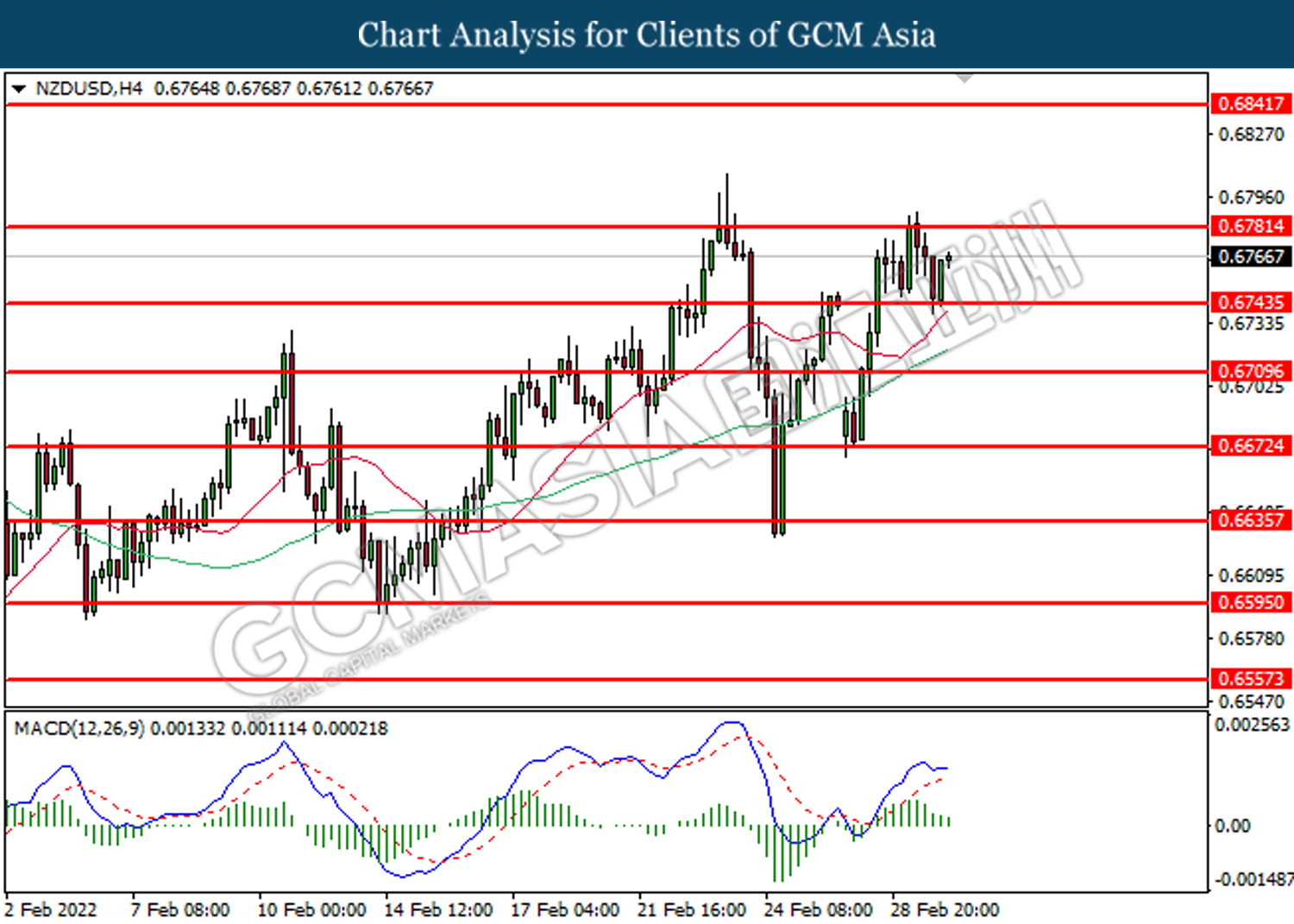

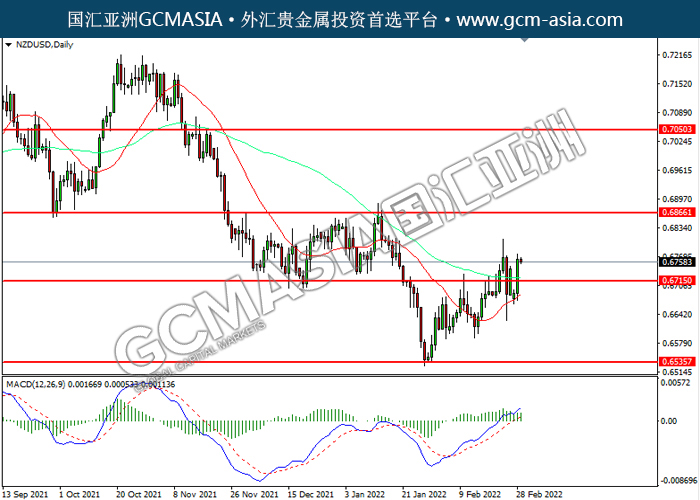

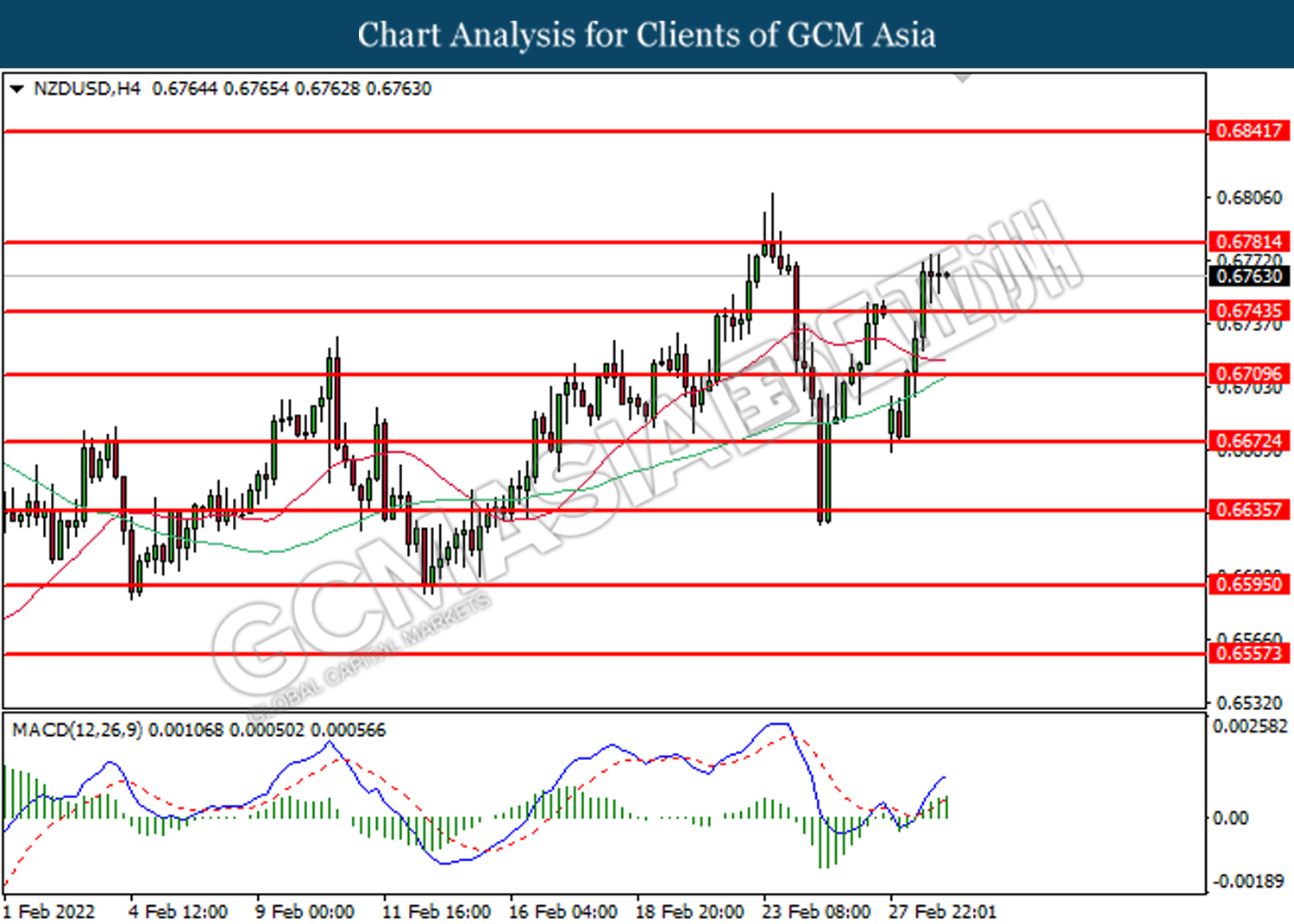

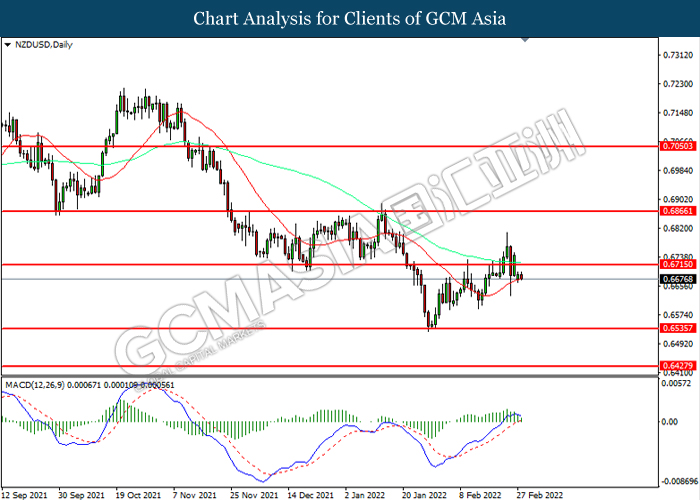

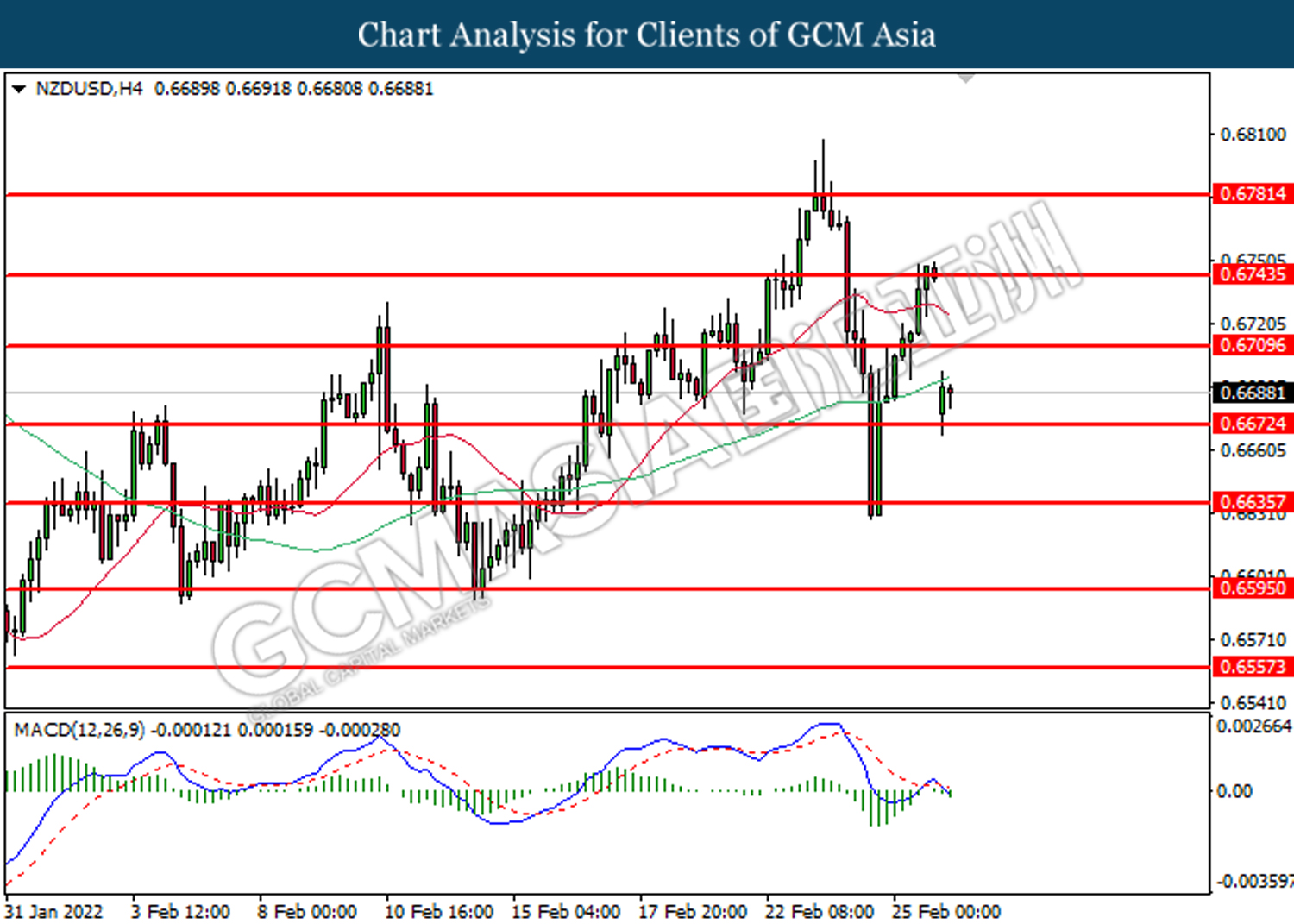

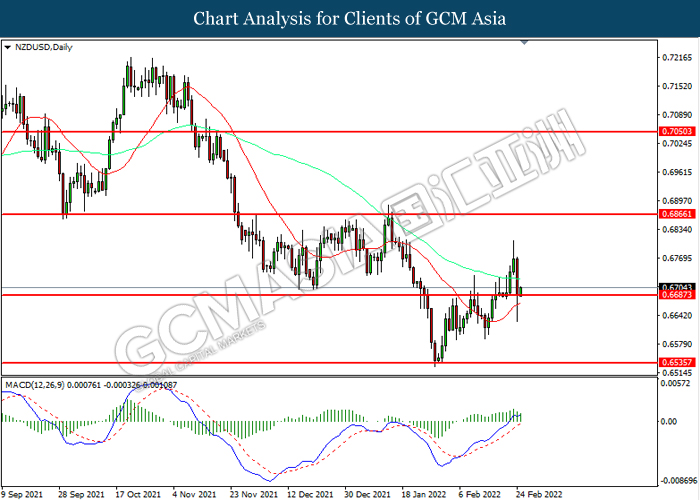

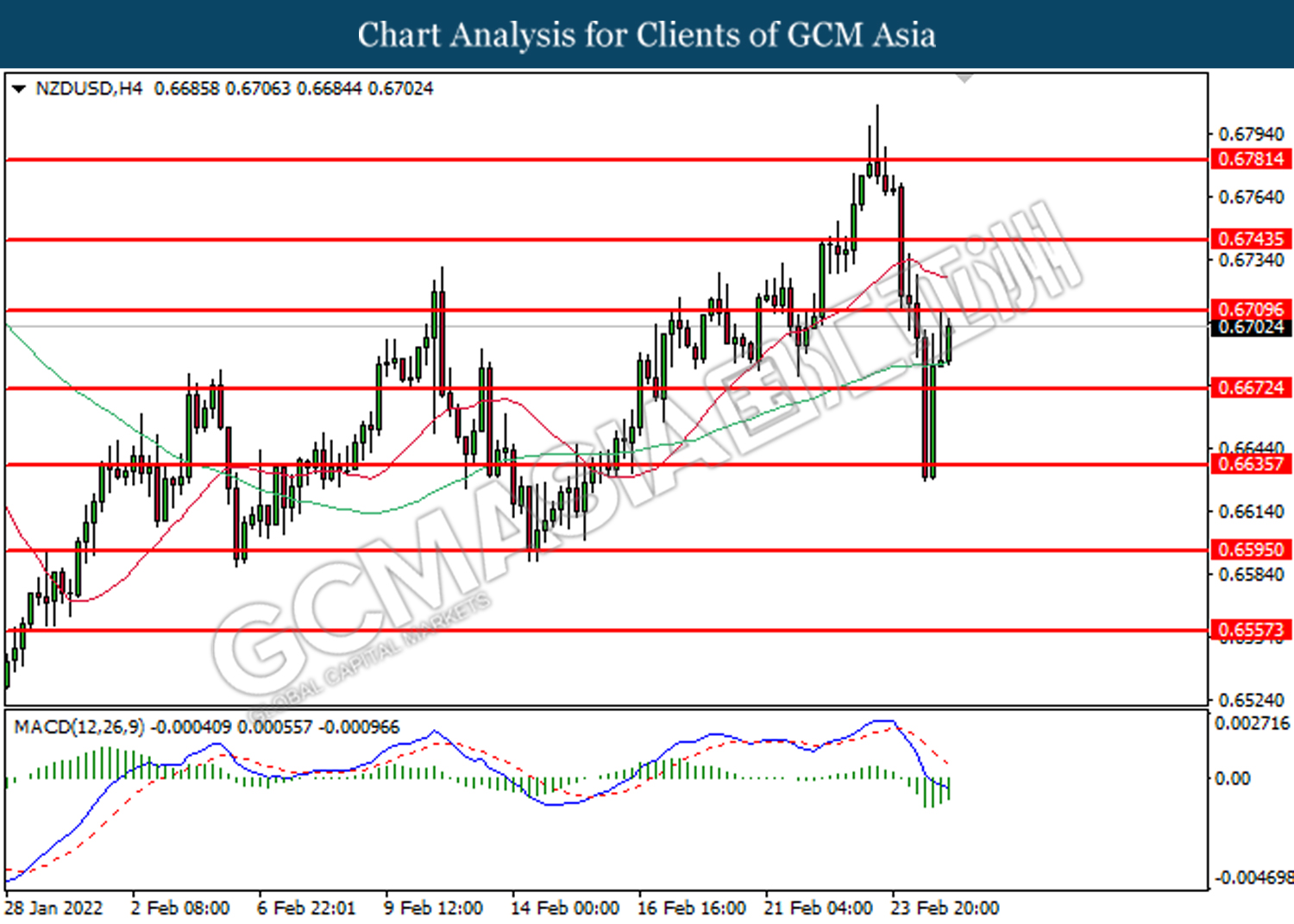

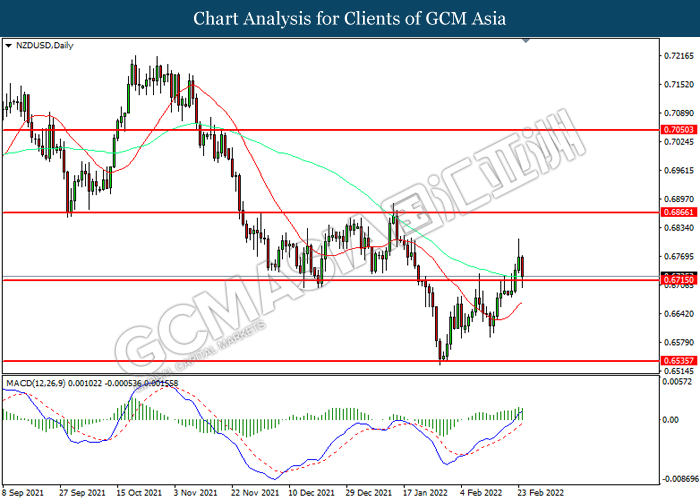

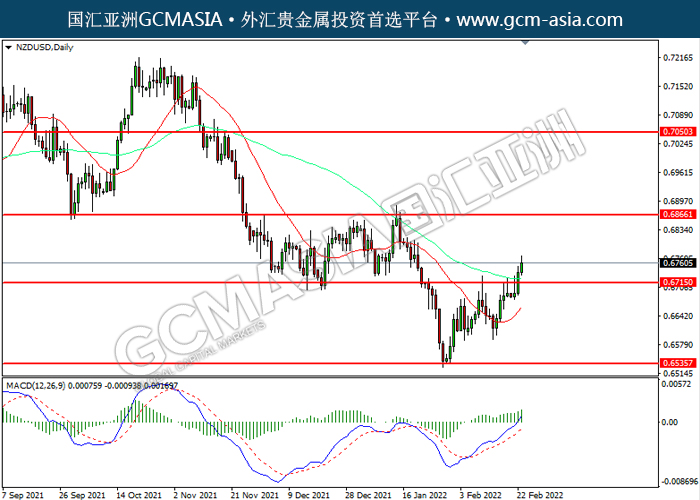

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

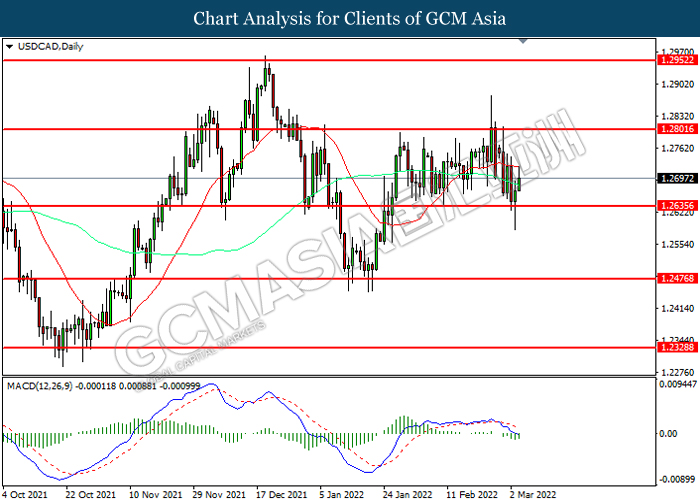

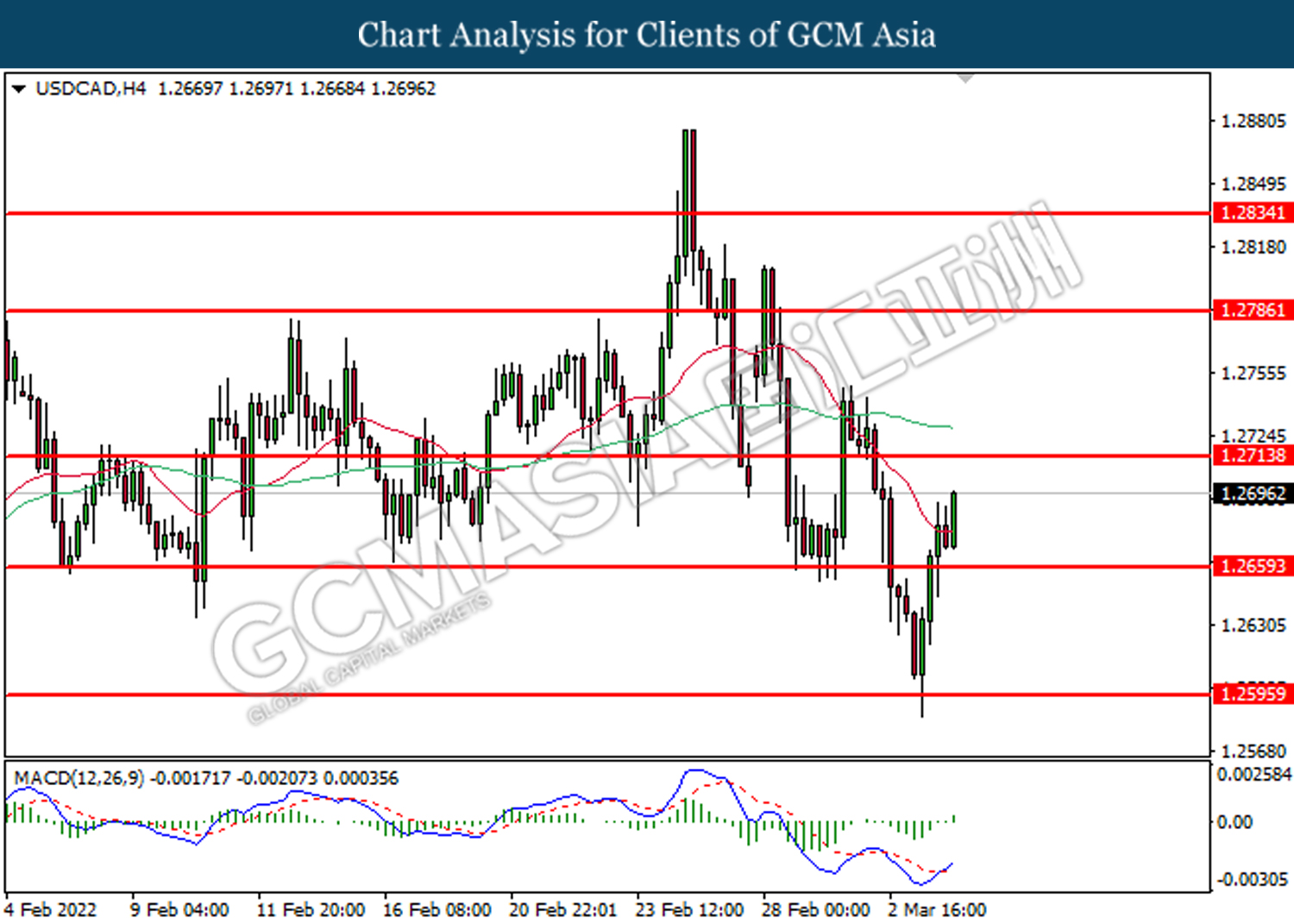

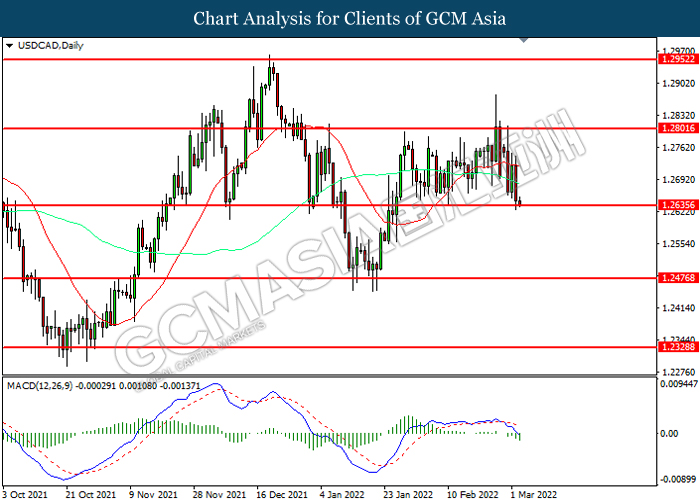

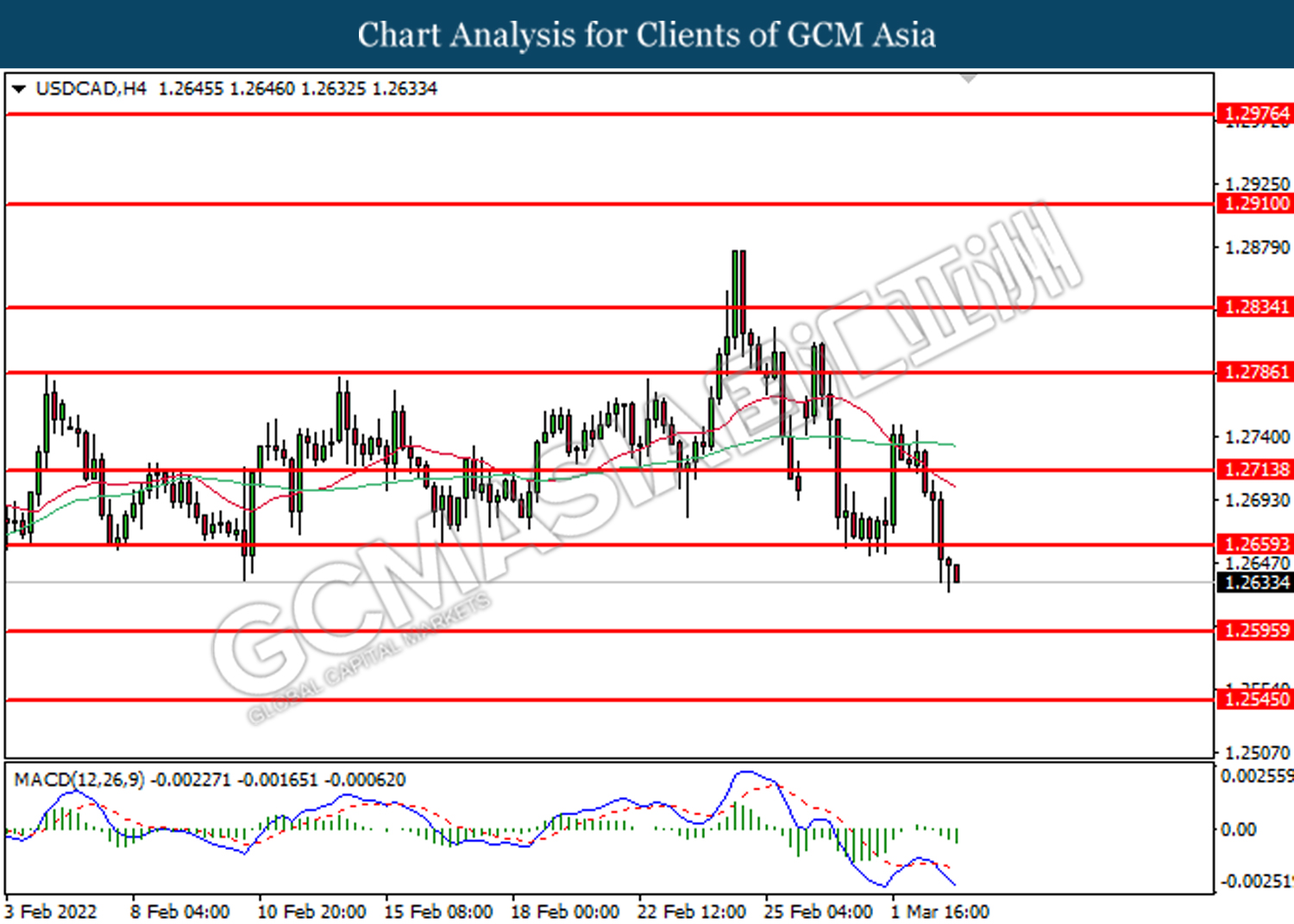

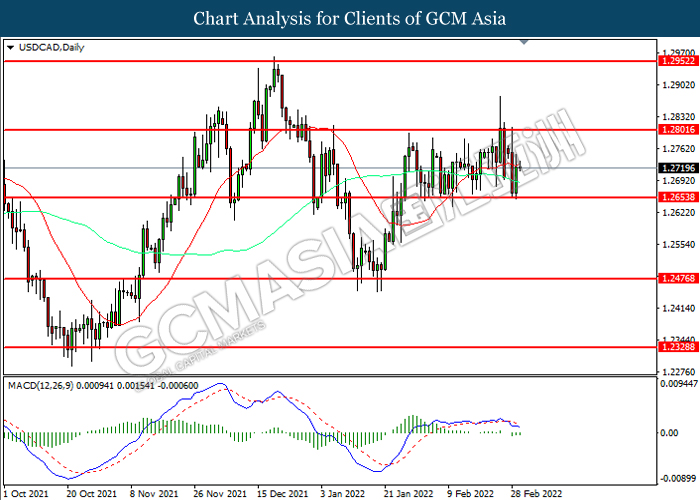

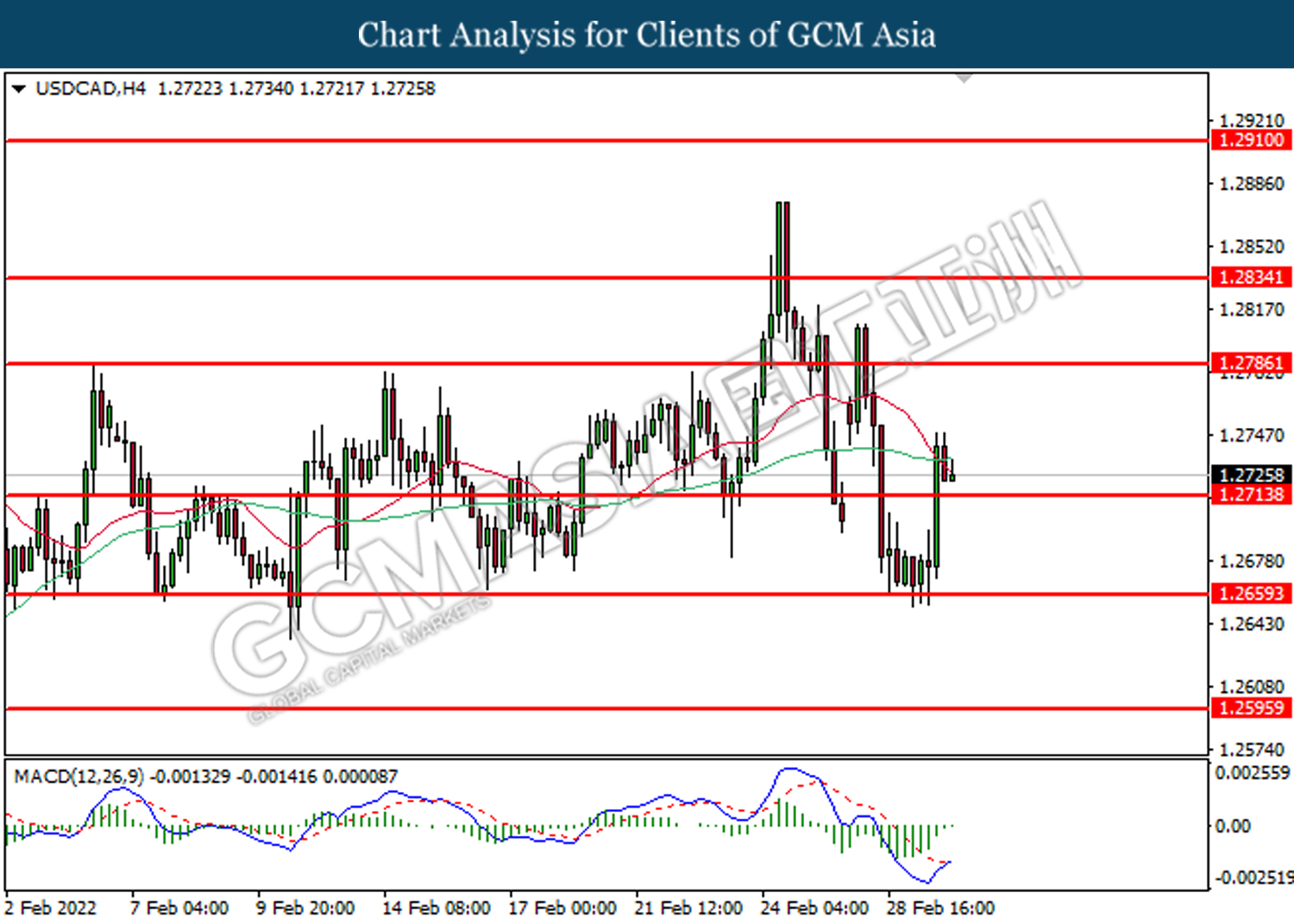

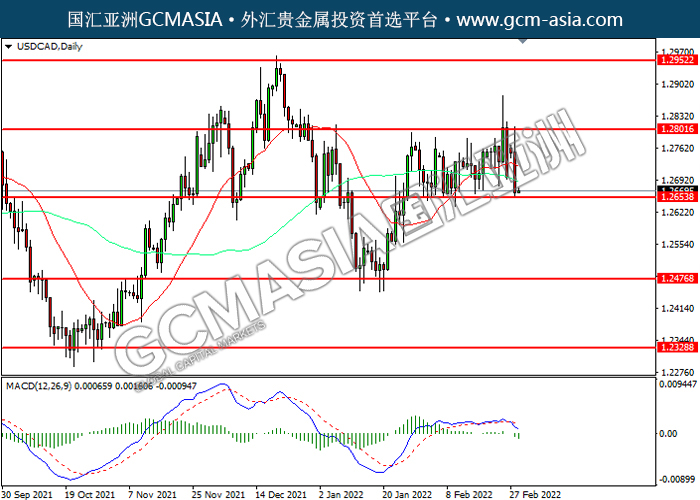

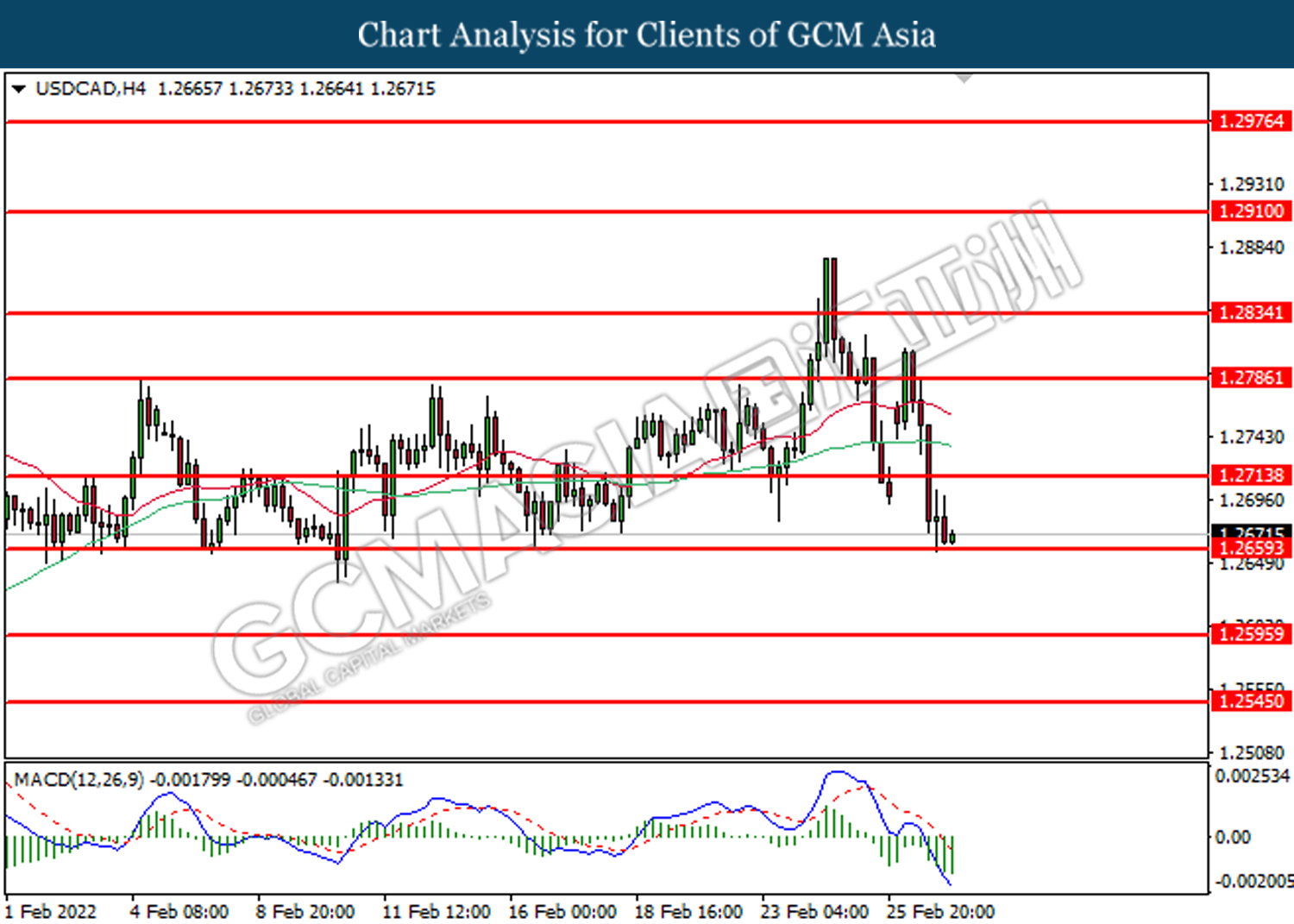

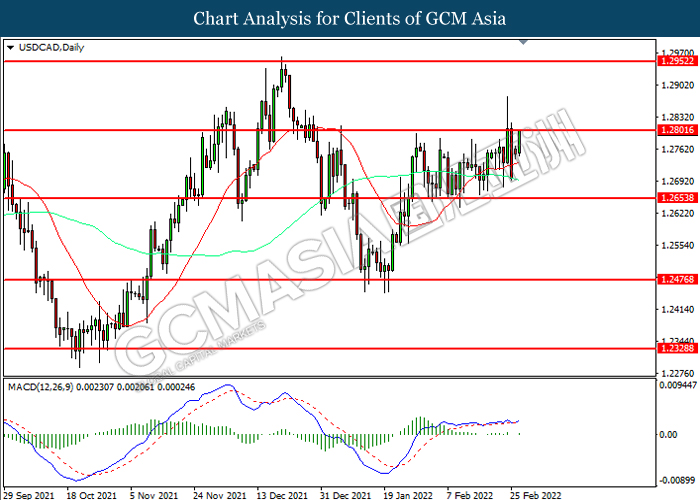

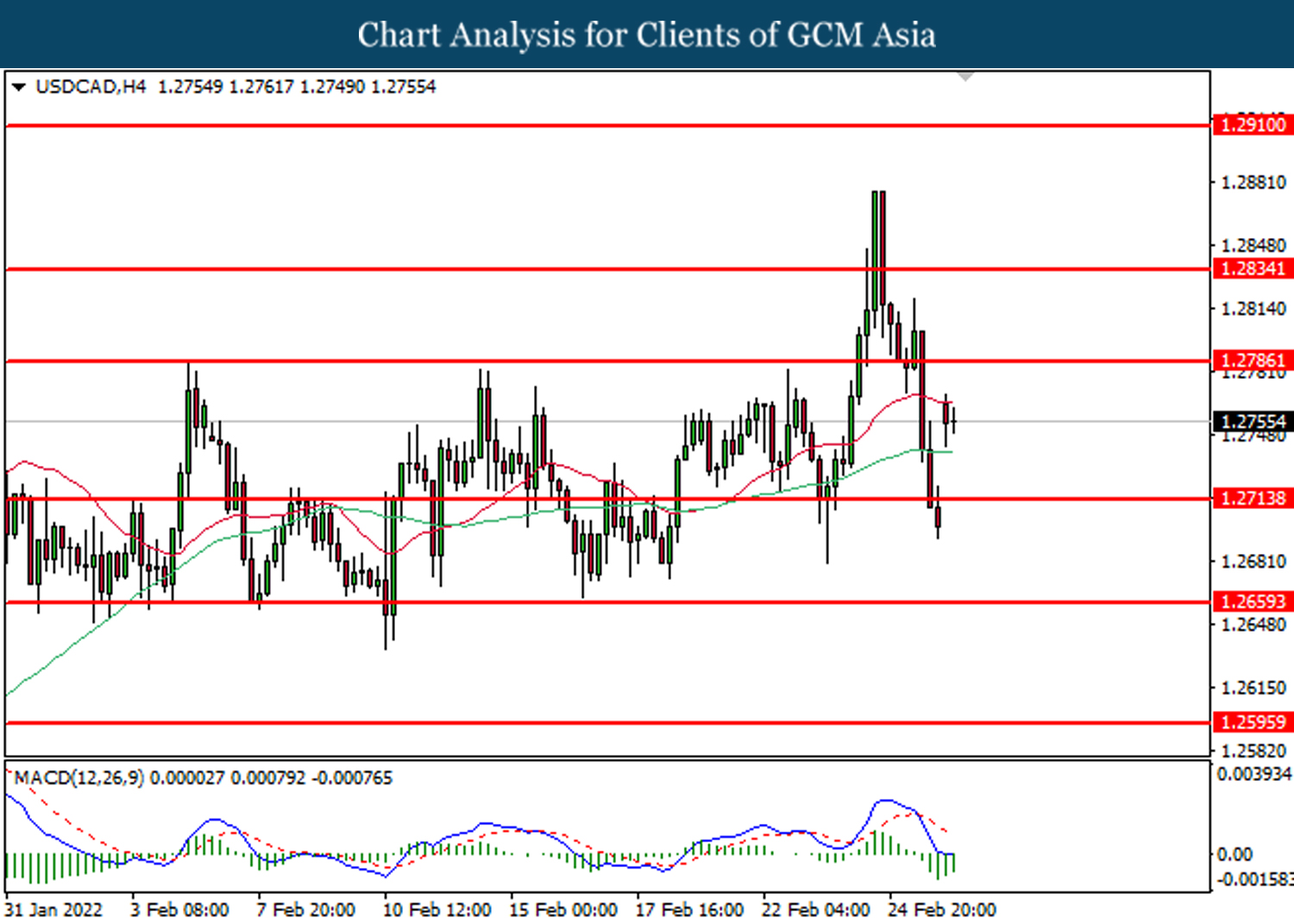

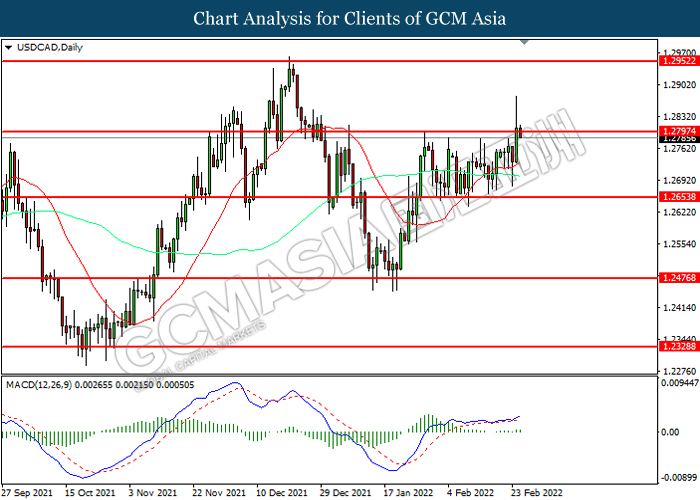

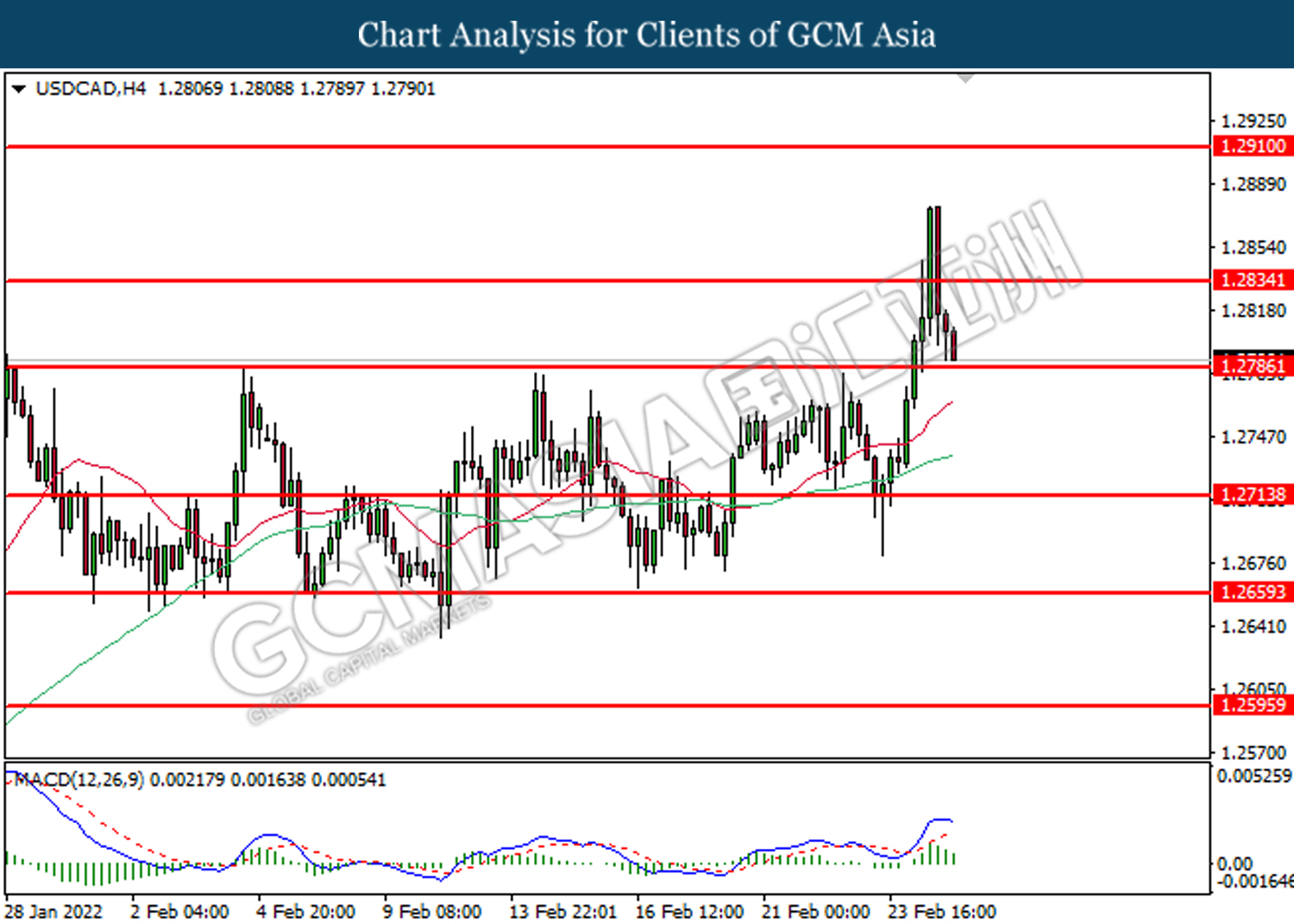

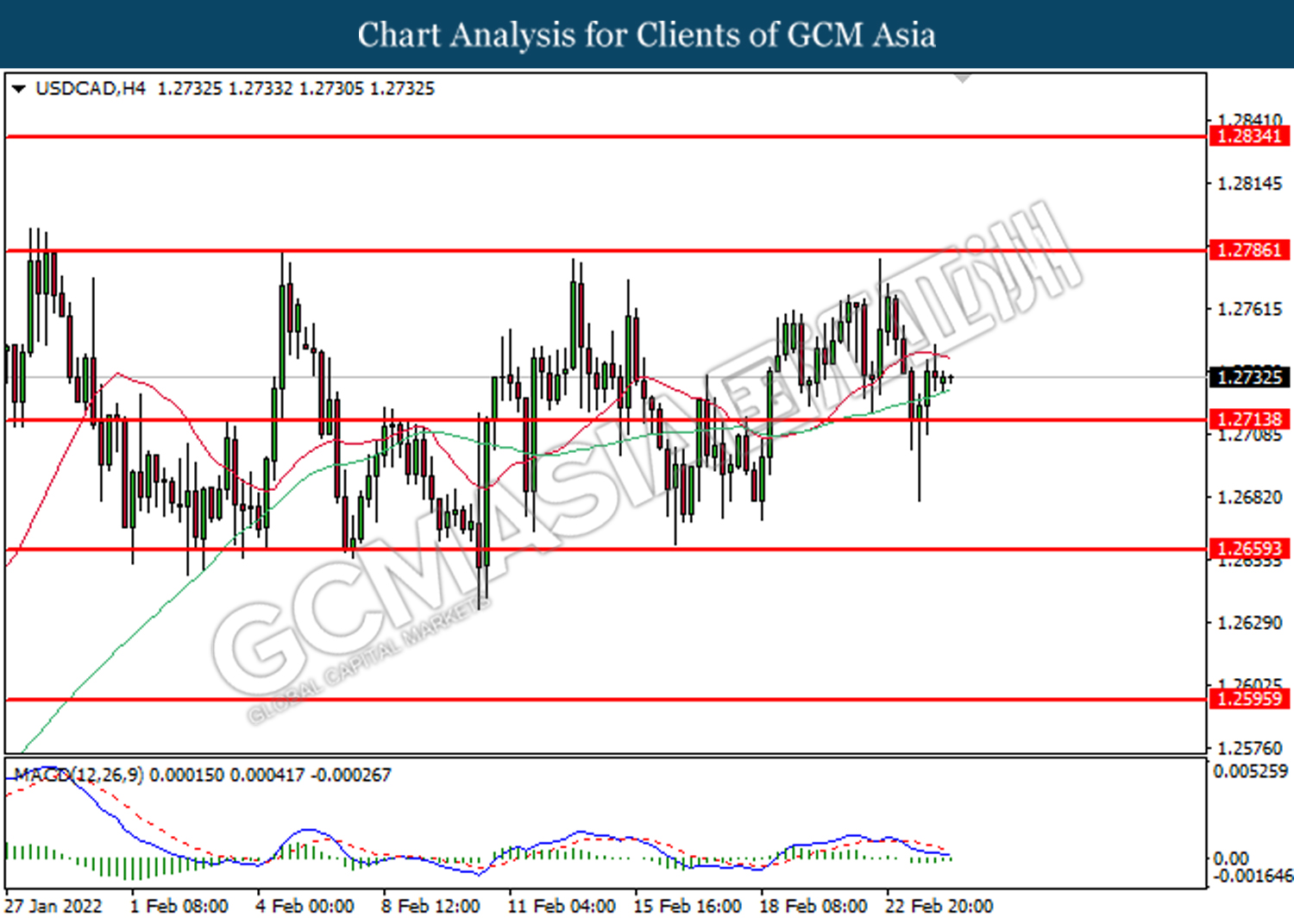

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2635. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2635, 1.2475

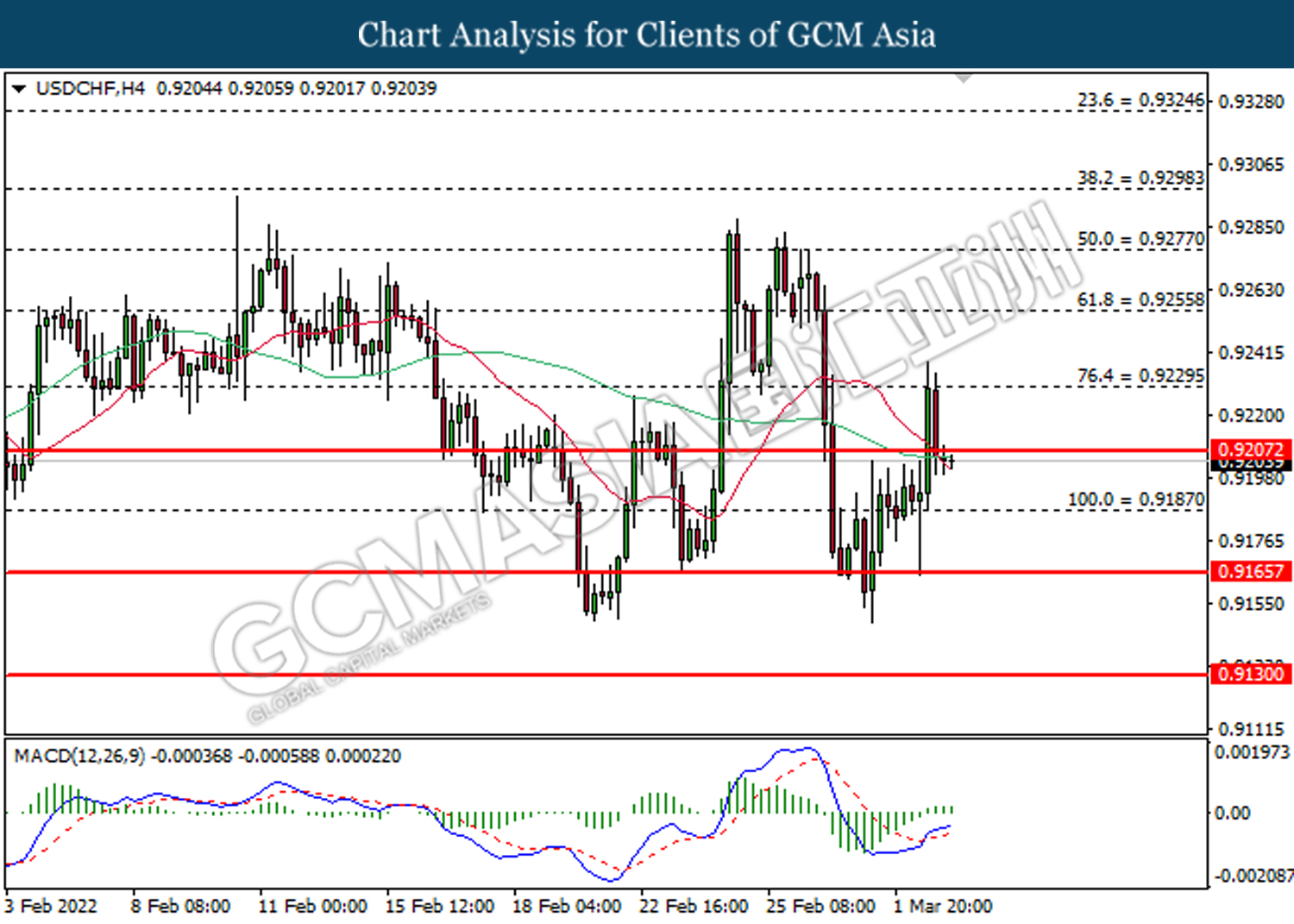

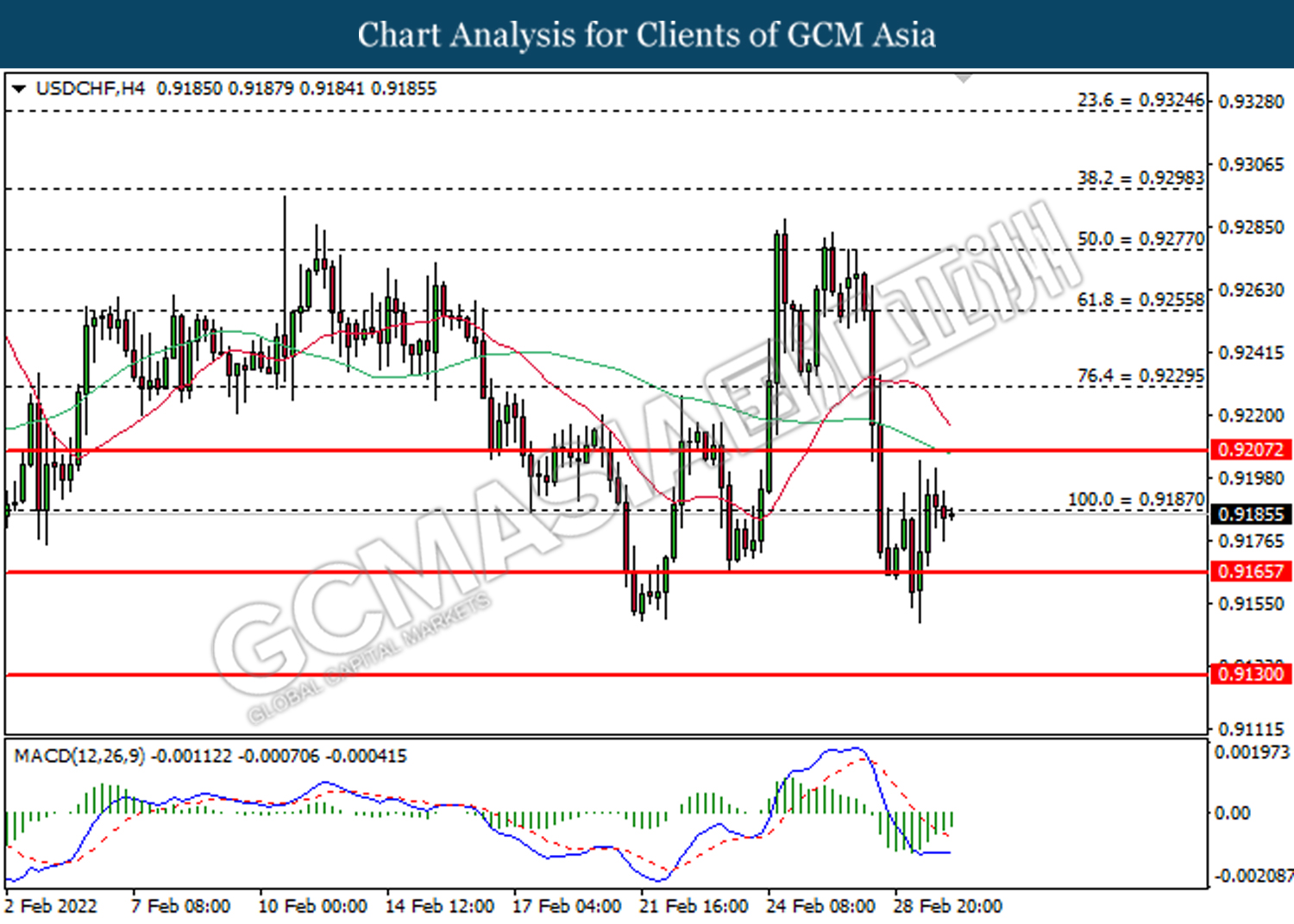

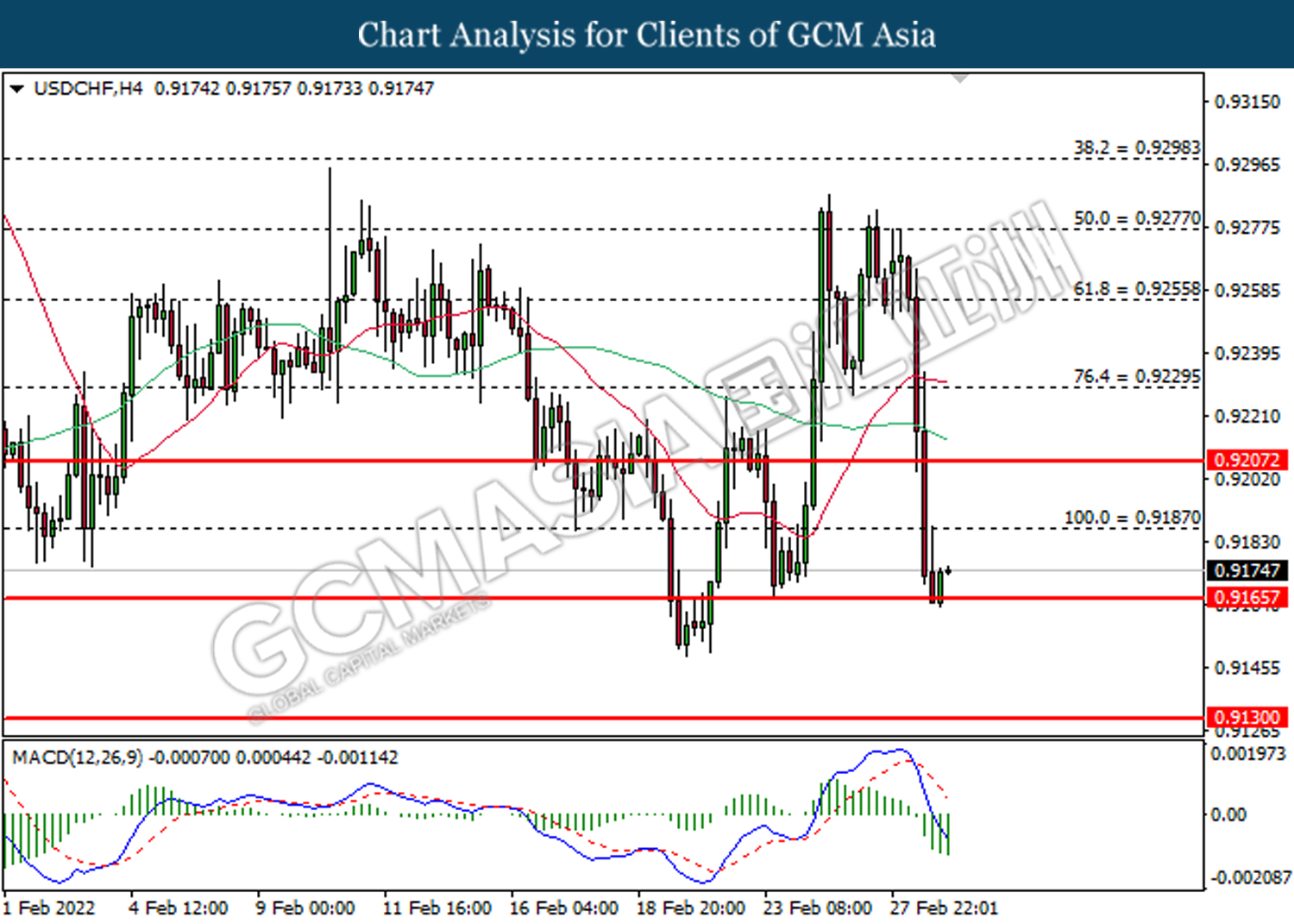

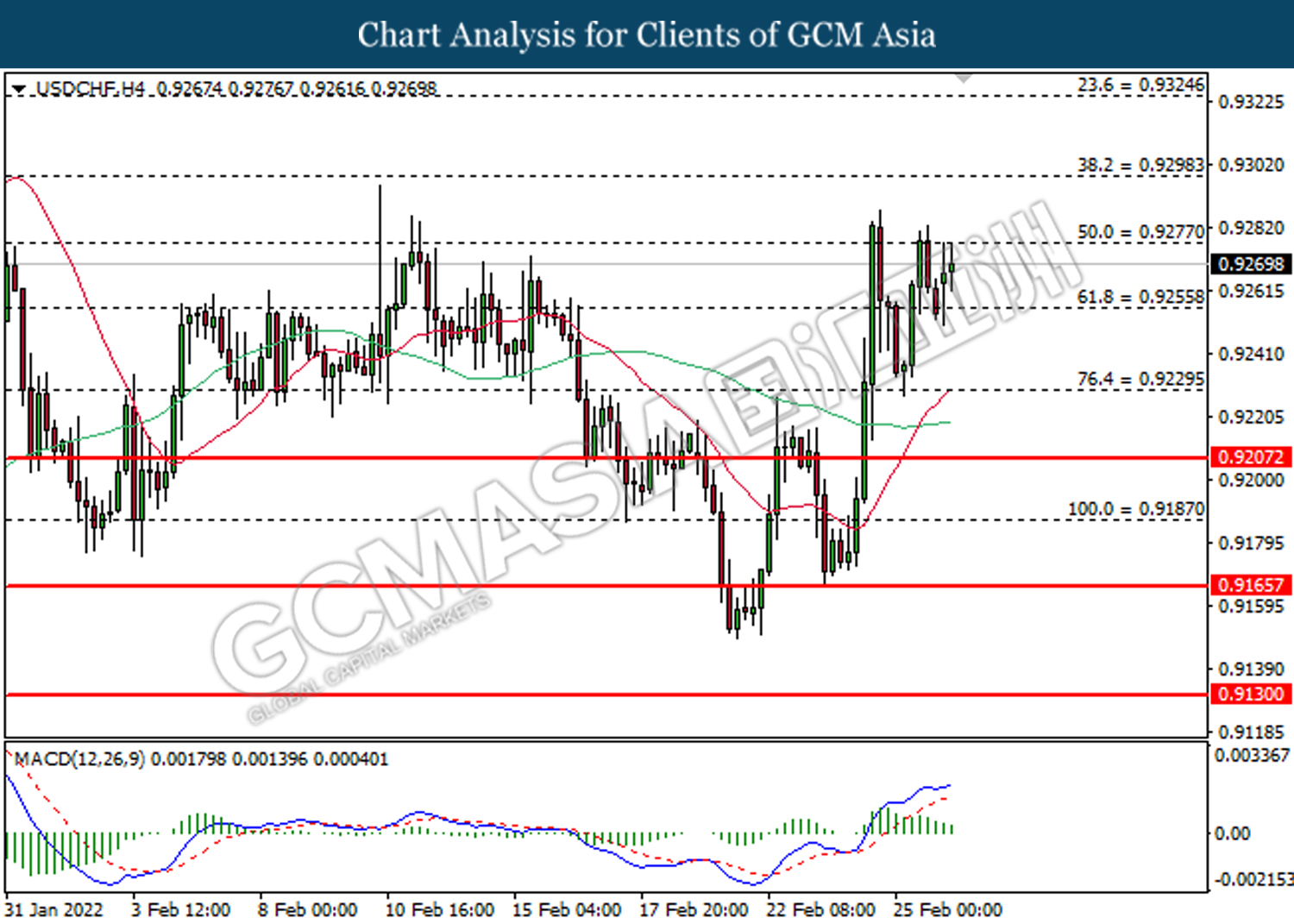

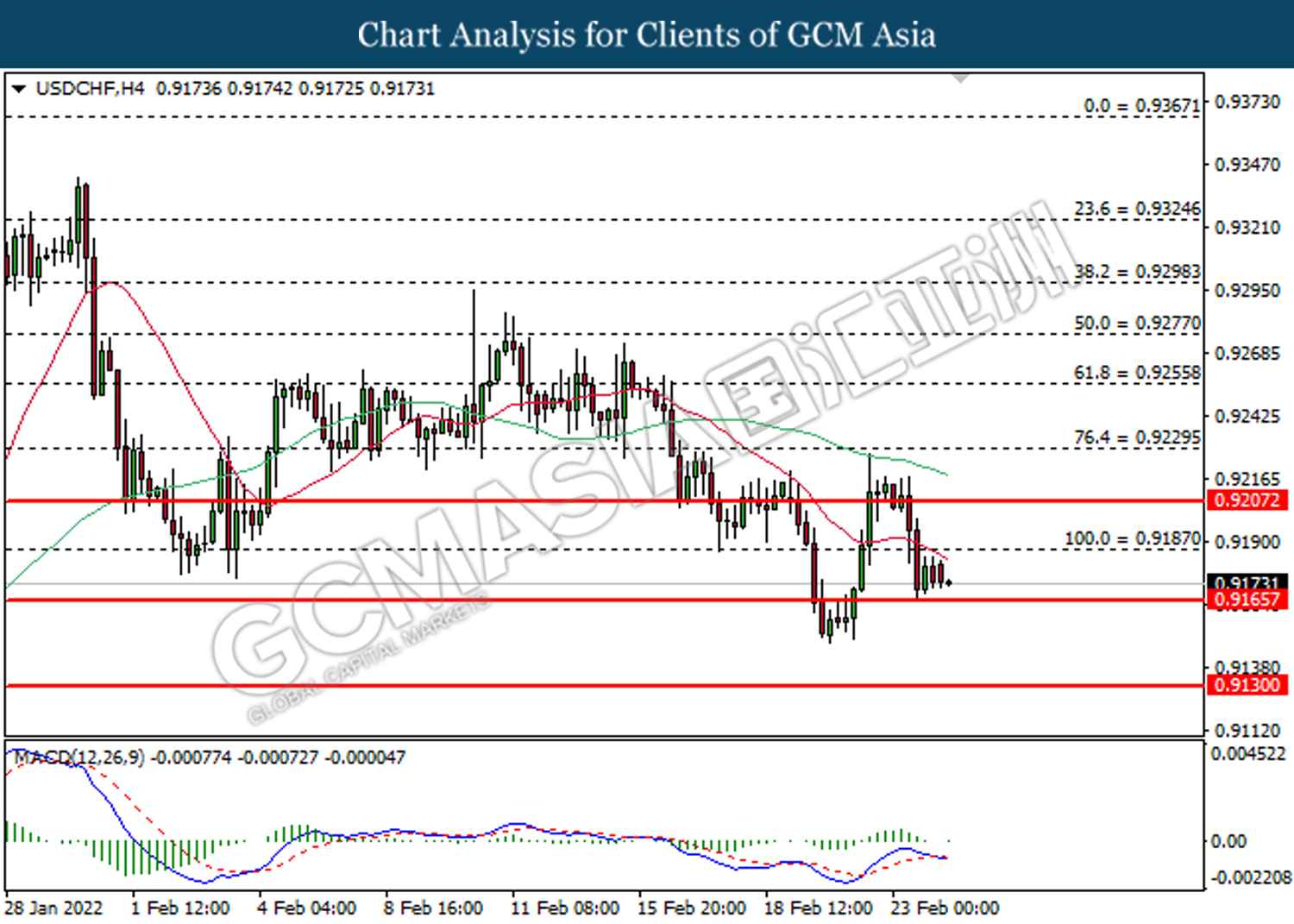

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

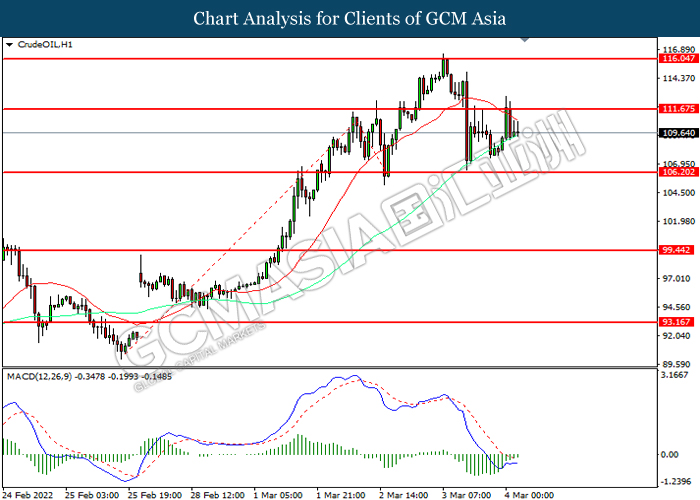

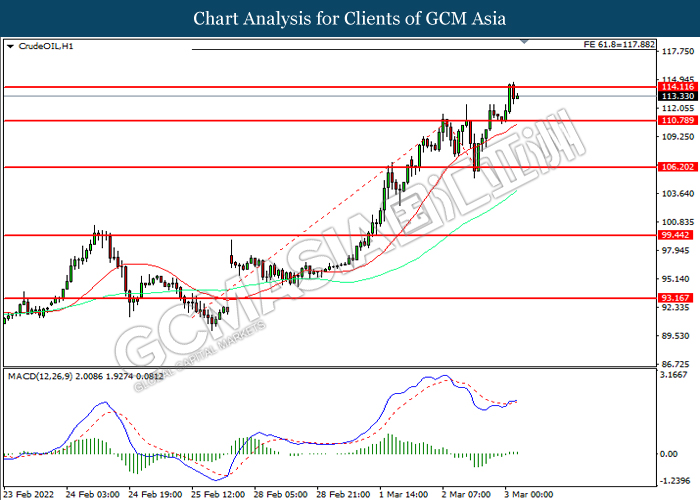

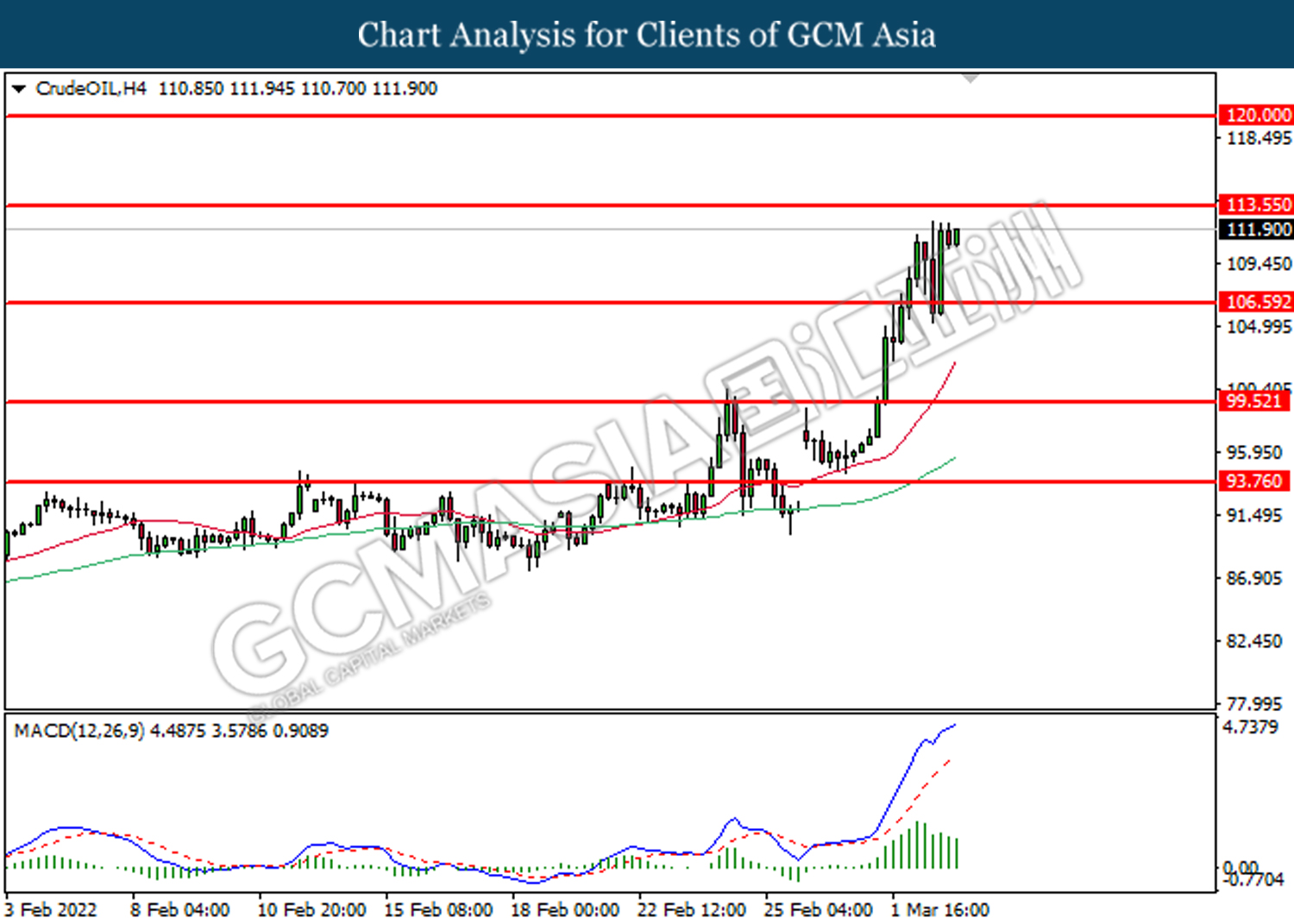

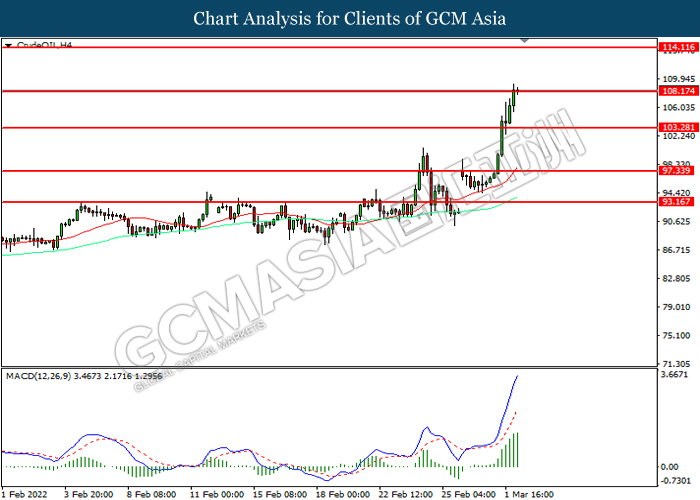

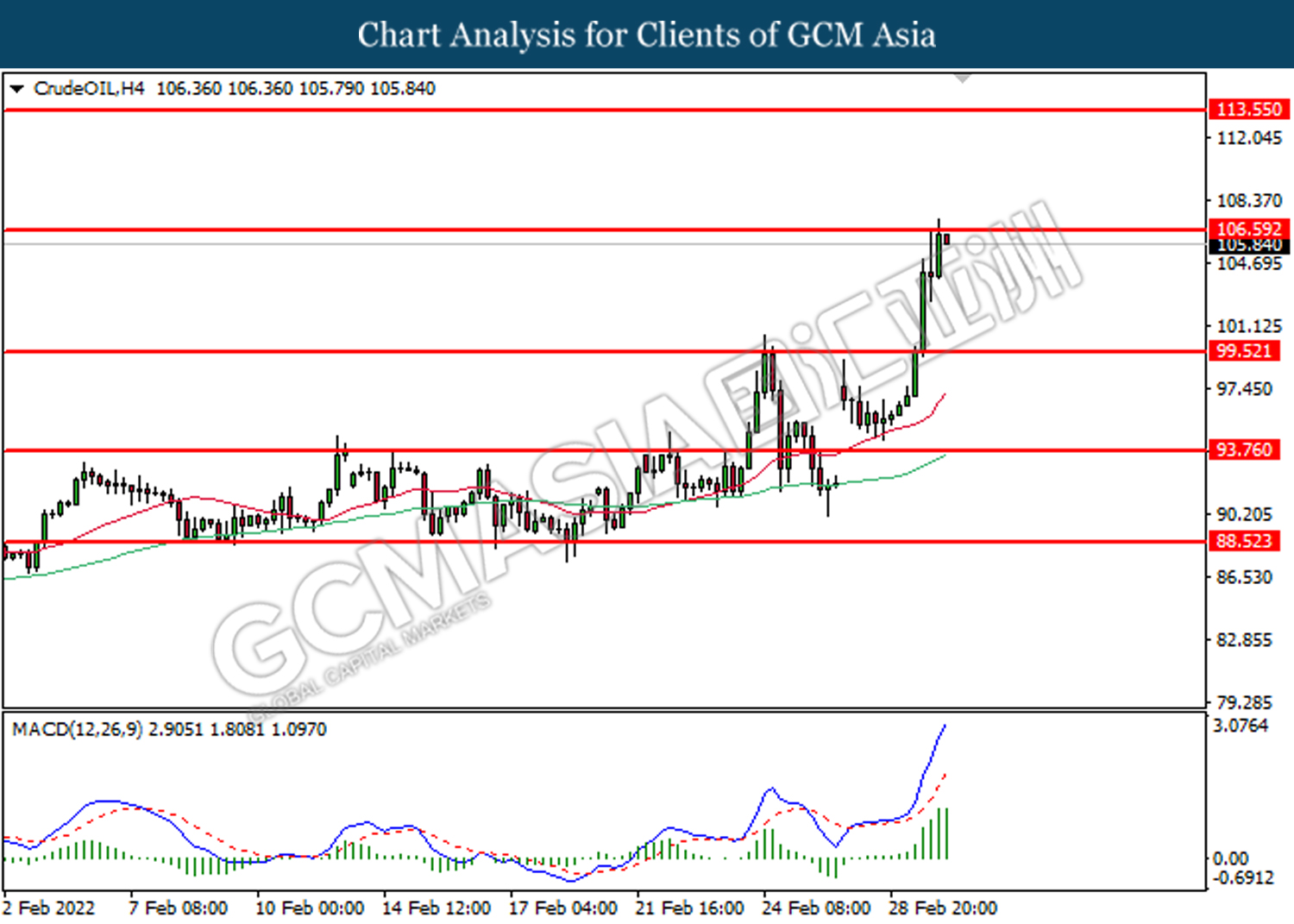

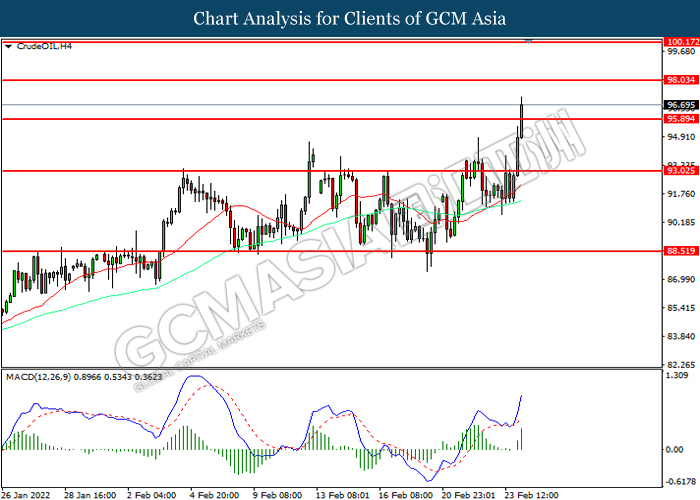

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 111.65. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 114.10, 117.90

Support level: 110.80, 106.20

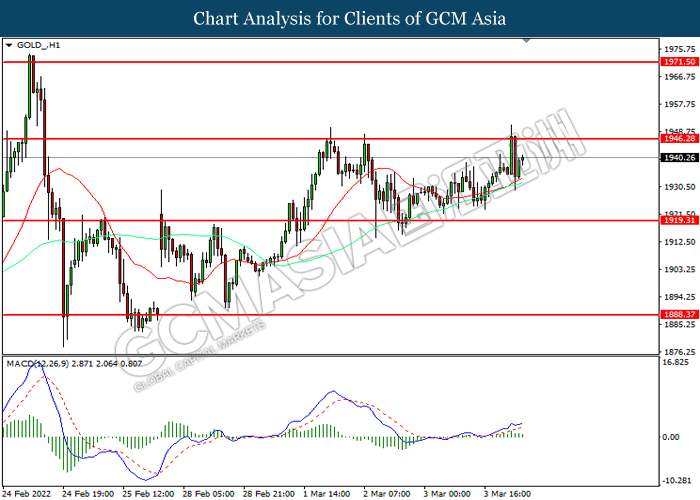

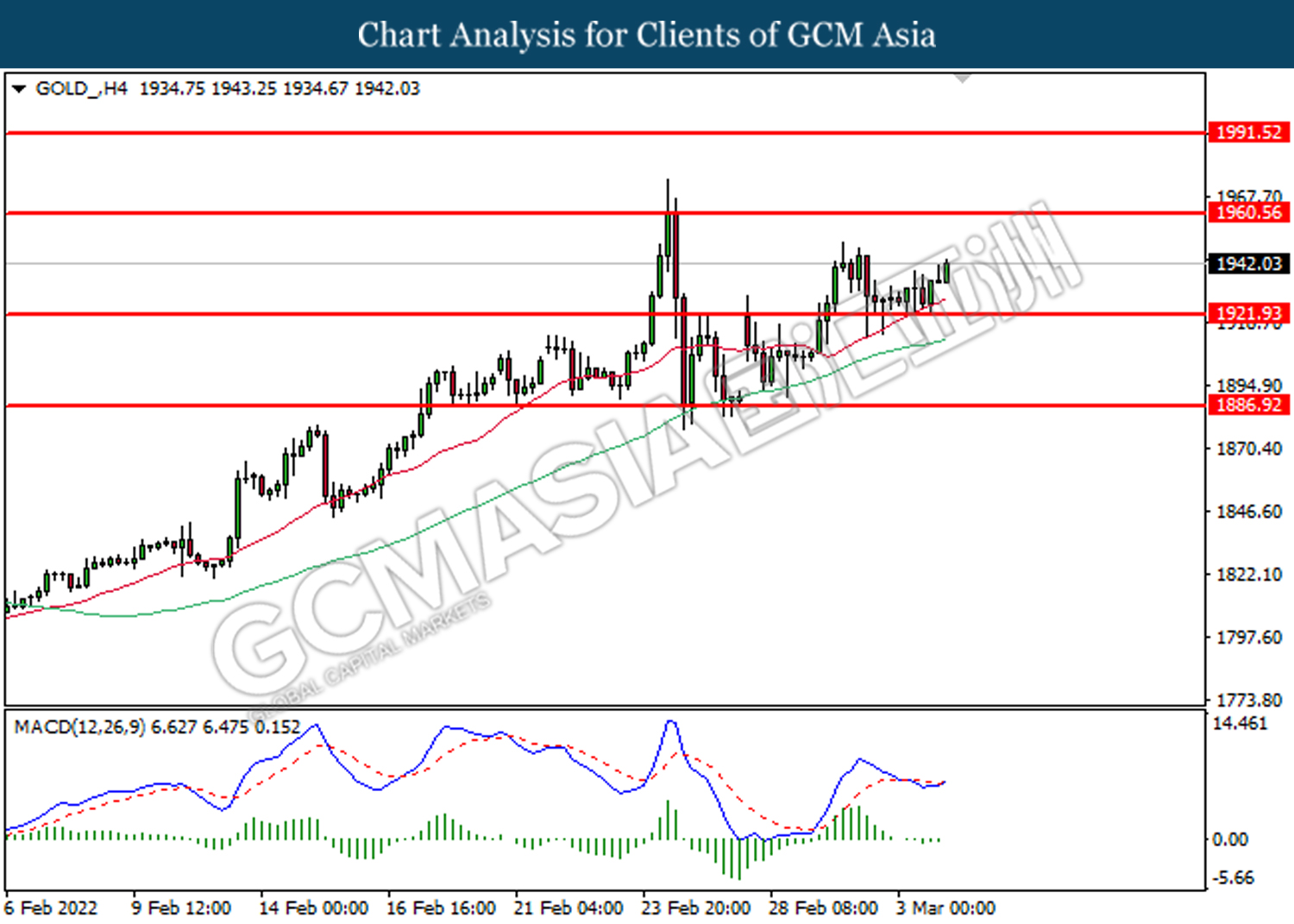

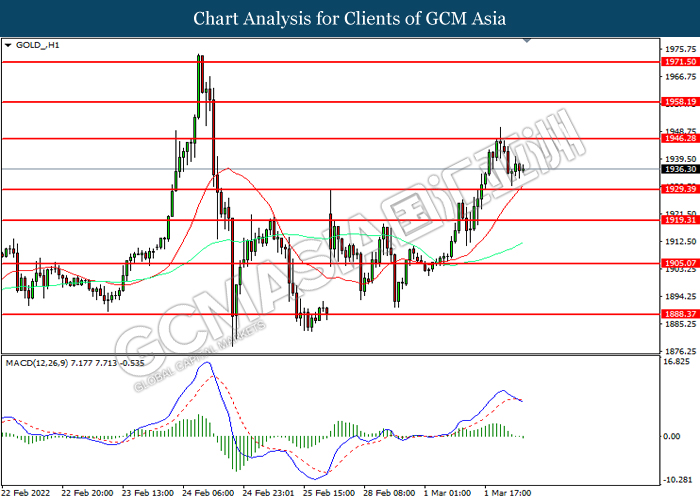

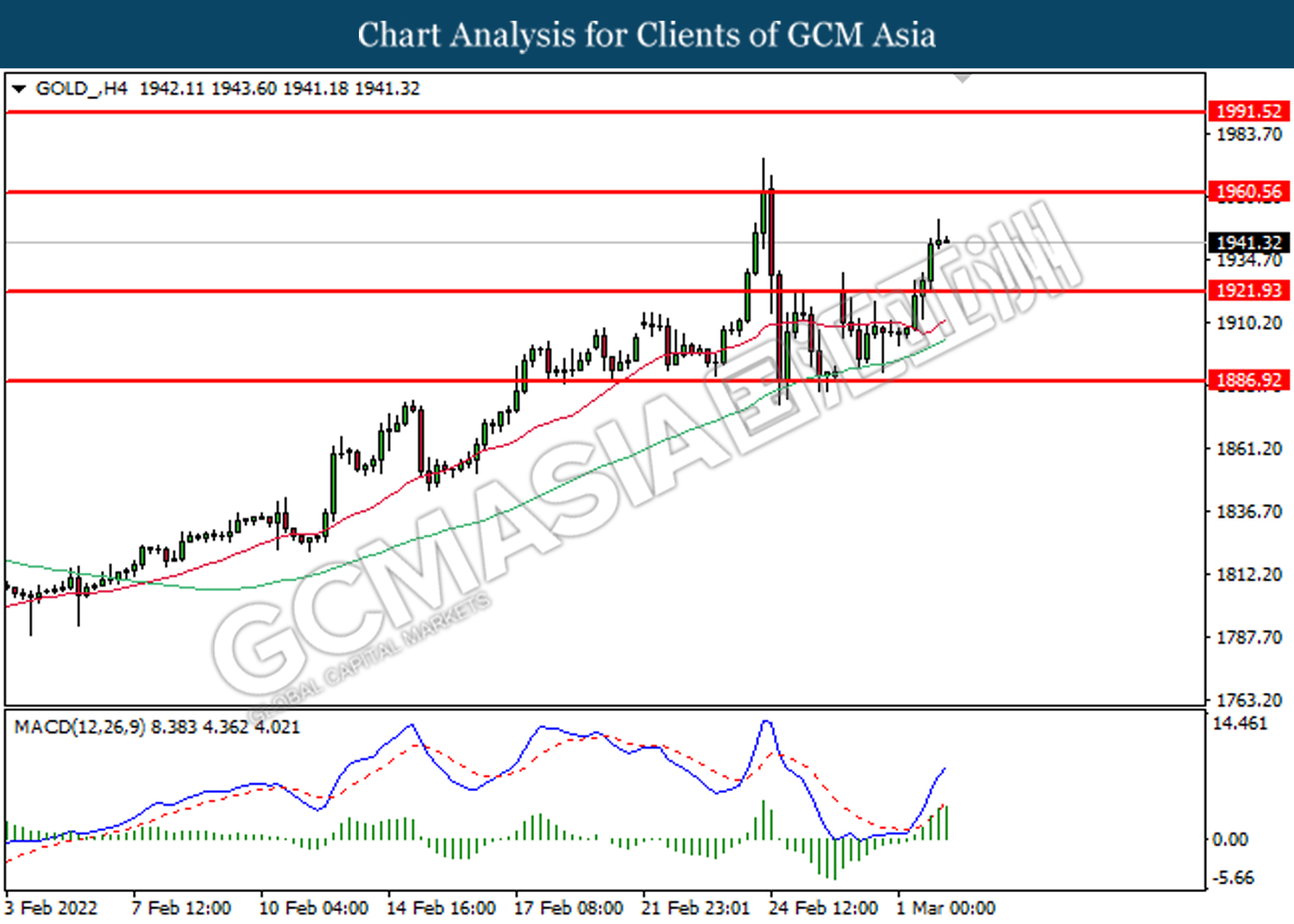

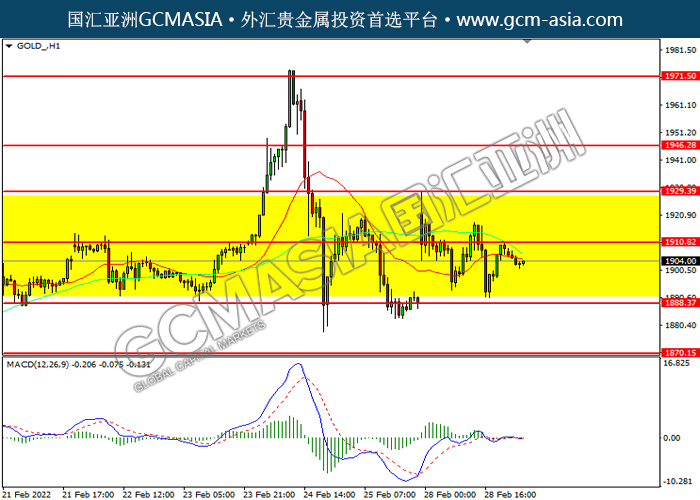

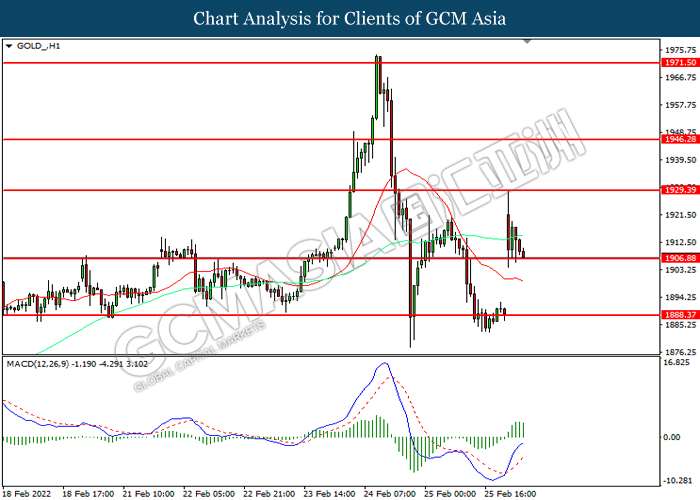

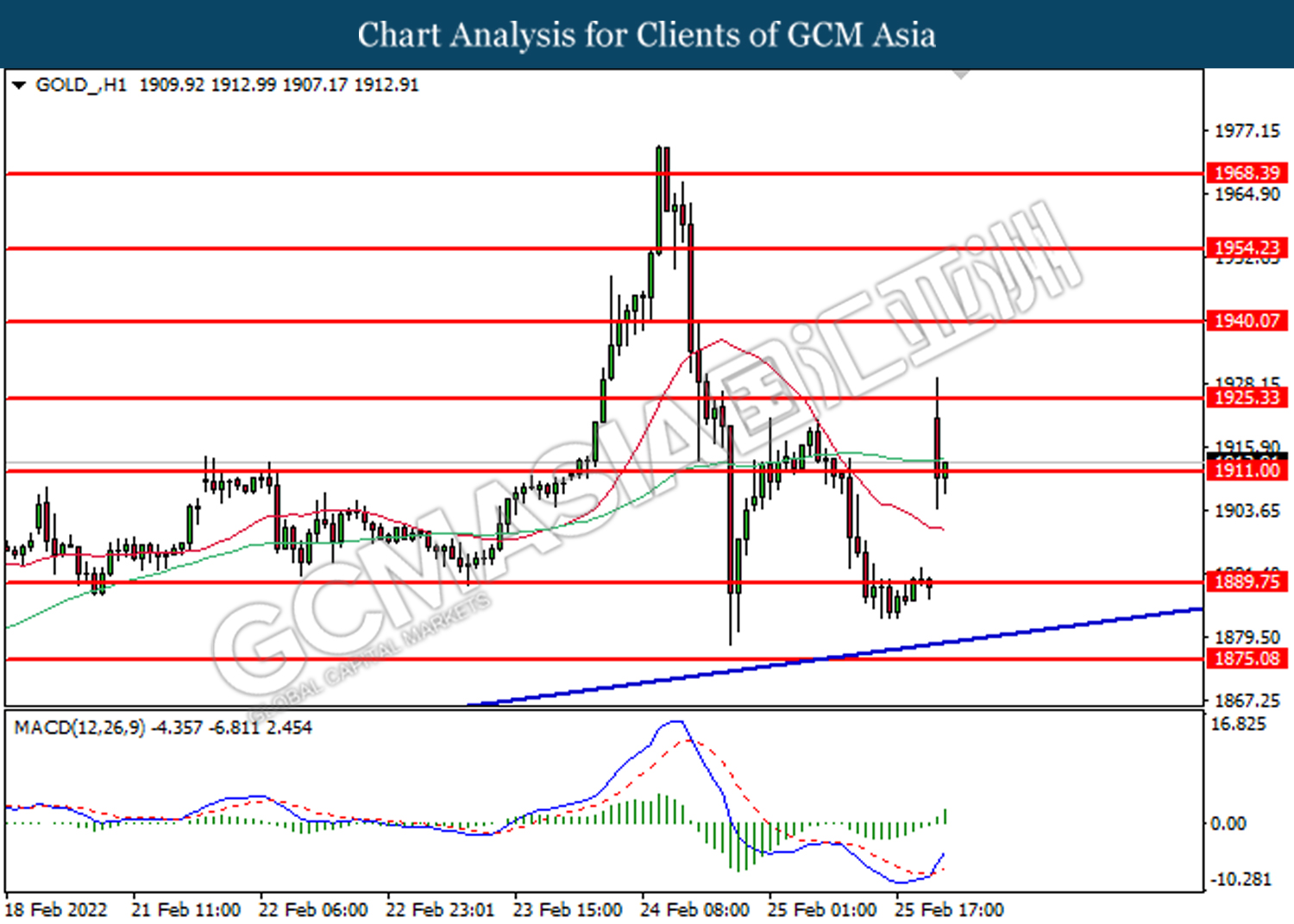

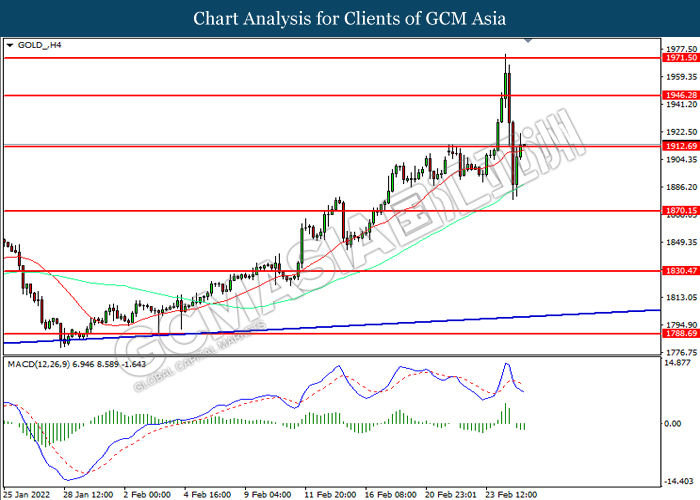

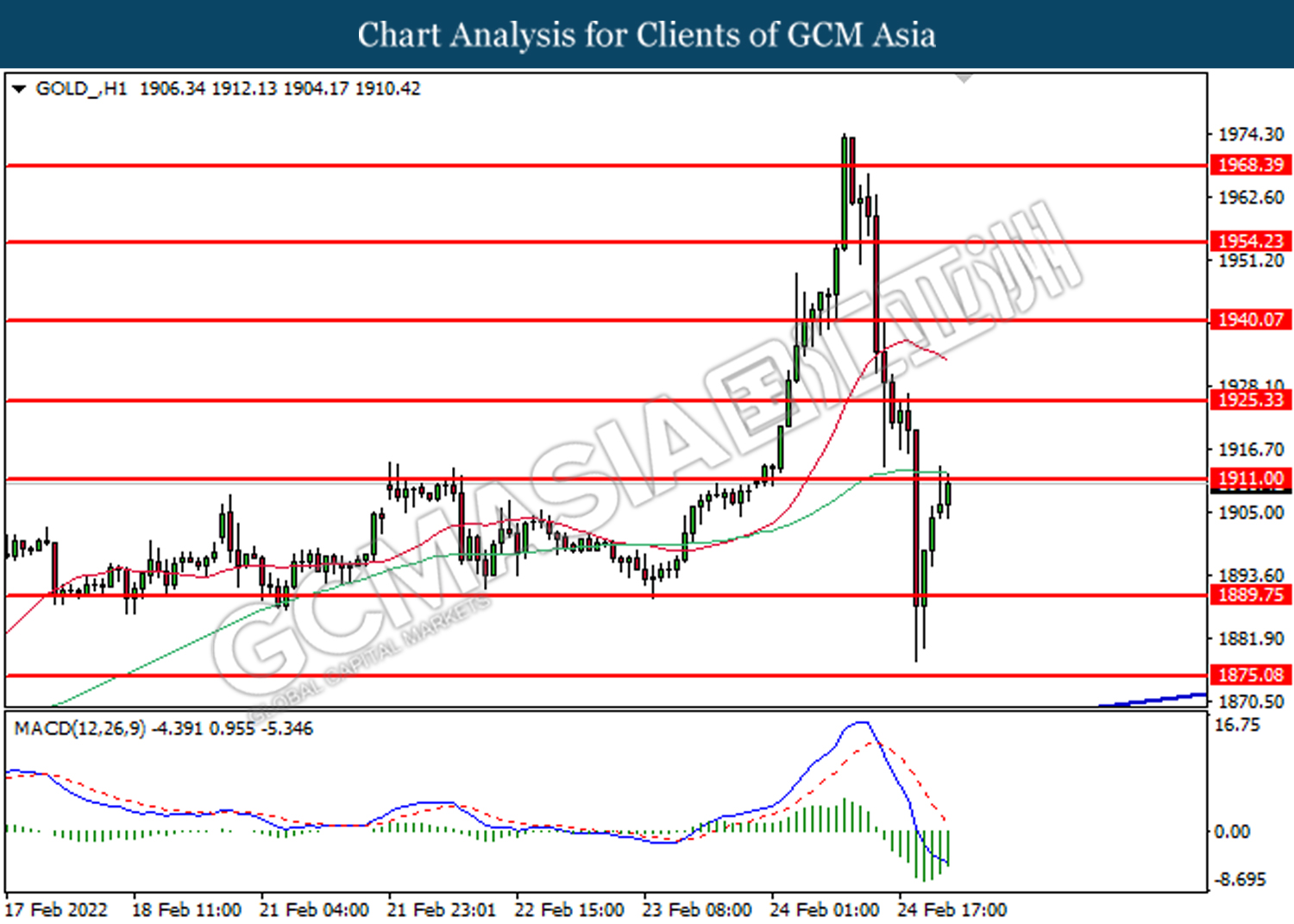

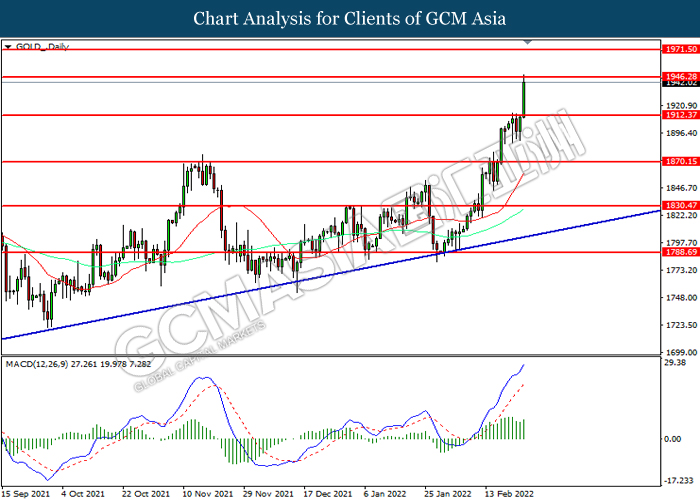

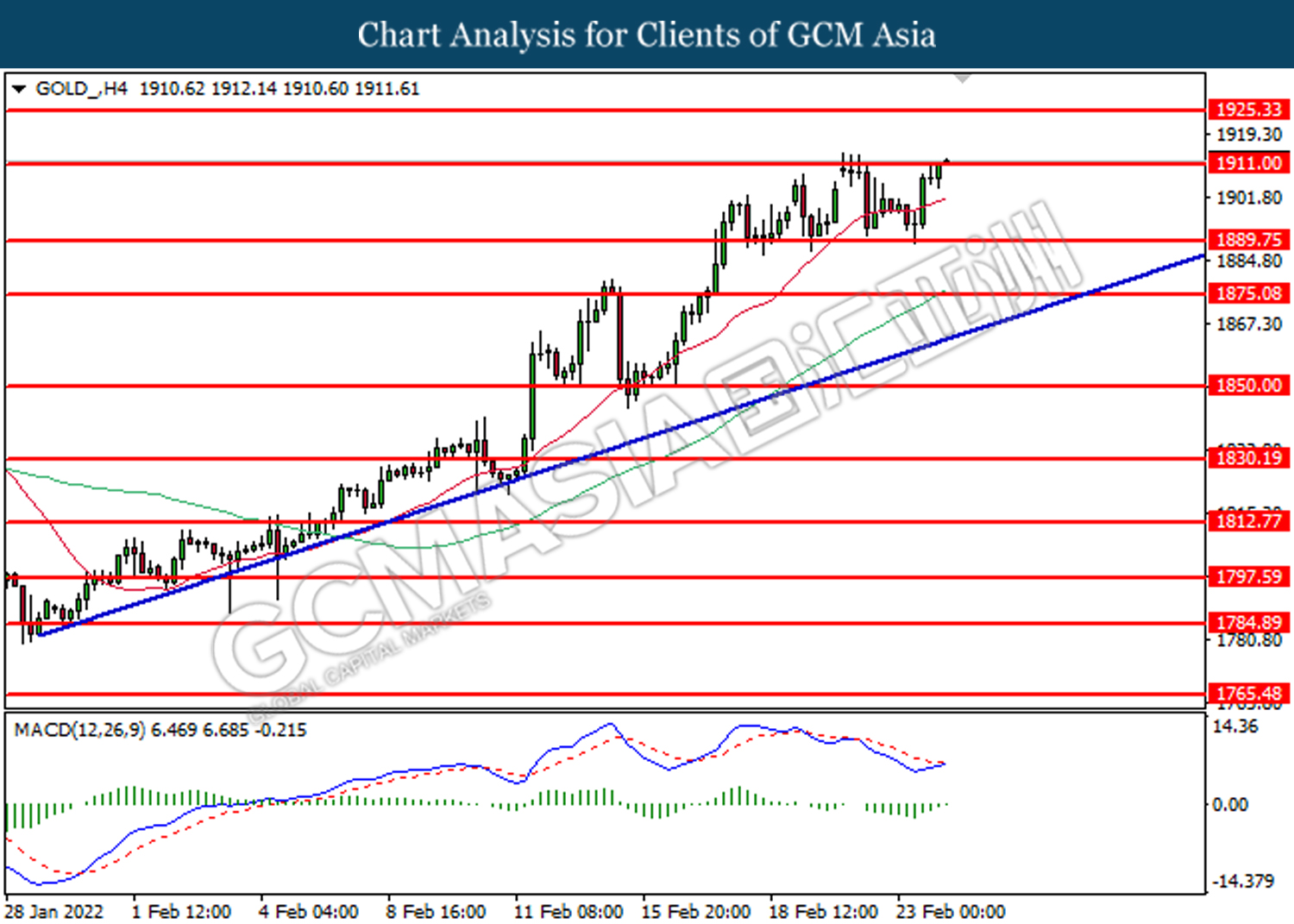

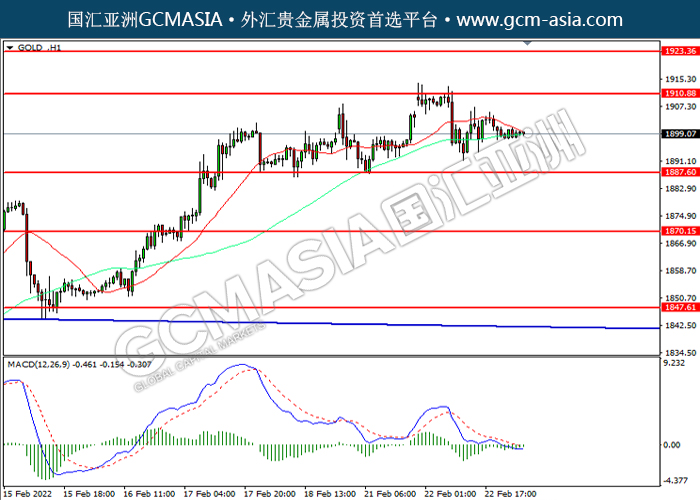

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level at 1946.30. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1919.30.

Resistance level: 1946.30, 1971.50

Support level: 1919.30, 1888.35

040322 Morning Session Analysis

4 March 2022 Morning Session Analysis

More frequent rate hike from Fed.

Market participants feed upon Federal Reserve’s latest hawkish signal following testimony from Fed Chair Jerome Powell. During the testimony session, Powell reiterates his support for a 25-basis point interest rate hike during their next policy meeting on 16th March 2022. Powell also emphasized that the central bank’s main focus will be placed upon curbing rising inflation even though Russia-Ukraine tension may create spillover effect on US economy. Likewise, he also commented that US economy is strong enough to weather through a few rounds of rate hike due to robust hiring after the pandemic. When asked with regards to the upper limit of interest rate, Powell suggests that it may be more than their projected range of 2-2.5%, while all decisions will be based on future economic data. As of writing, the dollar index was down slightly by 0.01% to 97.68.

As for commodities market, crude oil price was up by 0.85% to $109.29 per barrel following a rebound from lower levels. On the other hand, gold price depreciates by 0.05% to $1,935.78 a troy ounce due to diminishing risks in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | UK – Construction PMI (Feb) | 56.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 467K | 450K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 4.00% | 3.90% | – |

| 23:00 | CAD – Ivey PMI (Feb) | 50.7 | – | – |

Technical Analysis

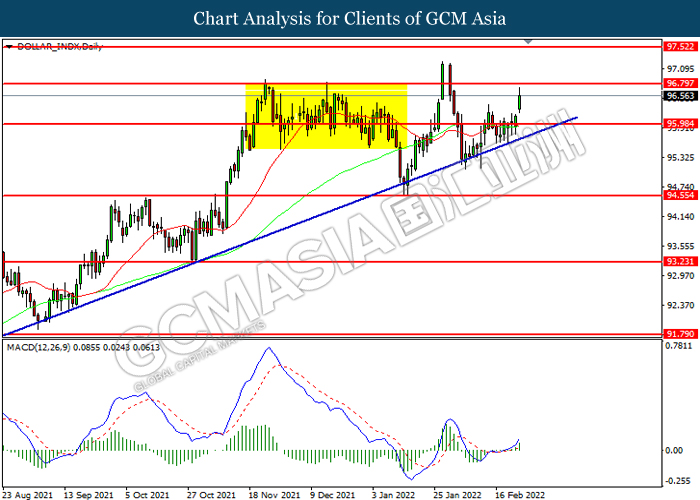

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

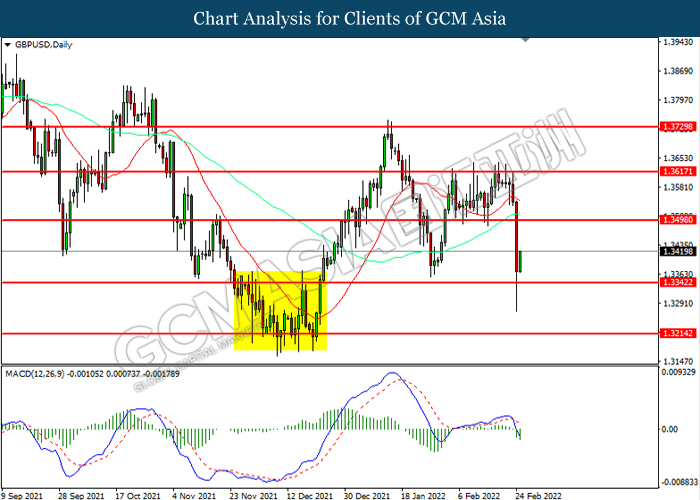

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which diminished illustrate bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3355, 1.3420

Support level: 1.3290, 1.3220

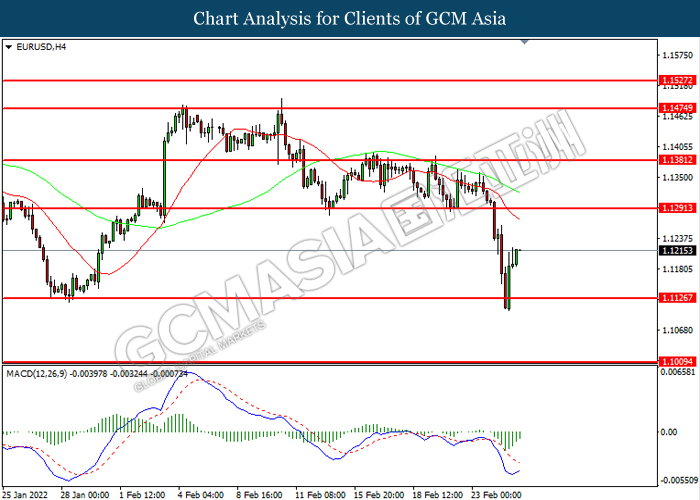

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1065, 1.1130

Support level: 1.0985, 1.0860

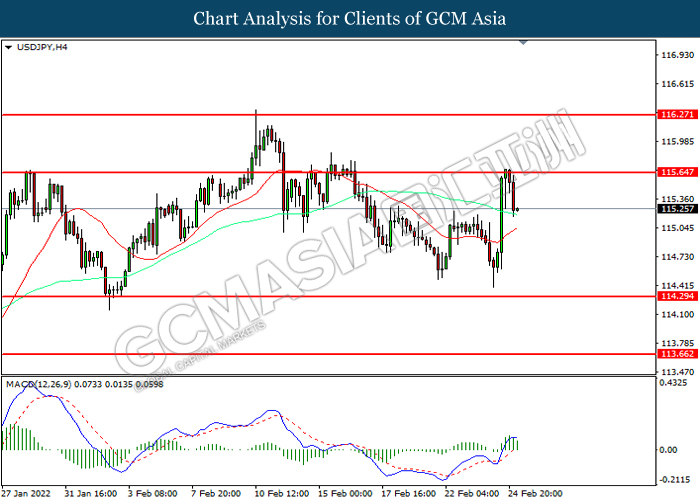

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

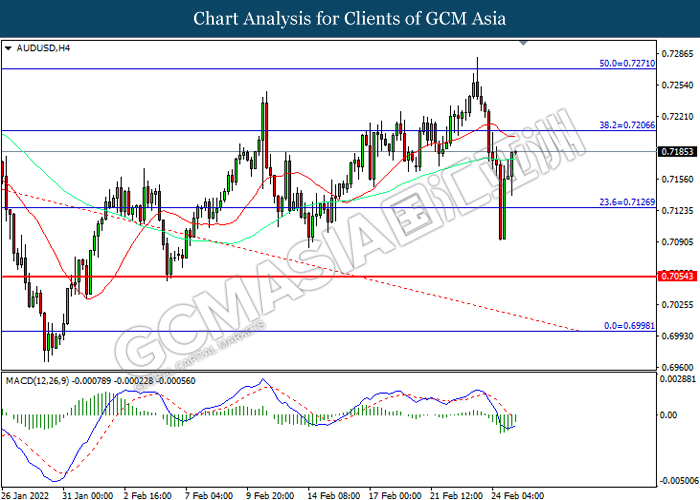

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which diminished illustrate bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7335, 0.7385

Support level: 0.7300, 0.7270

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6840, 0.6880

Support level: 0.6785, 0.6745

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2595

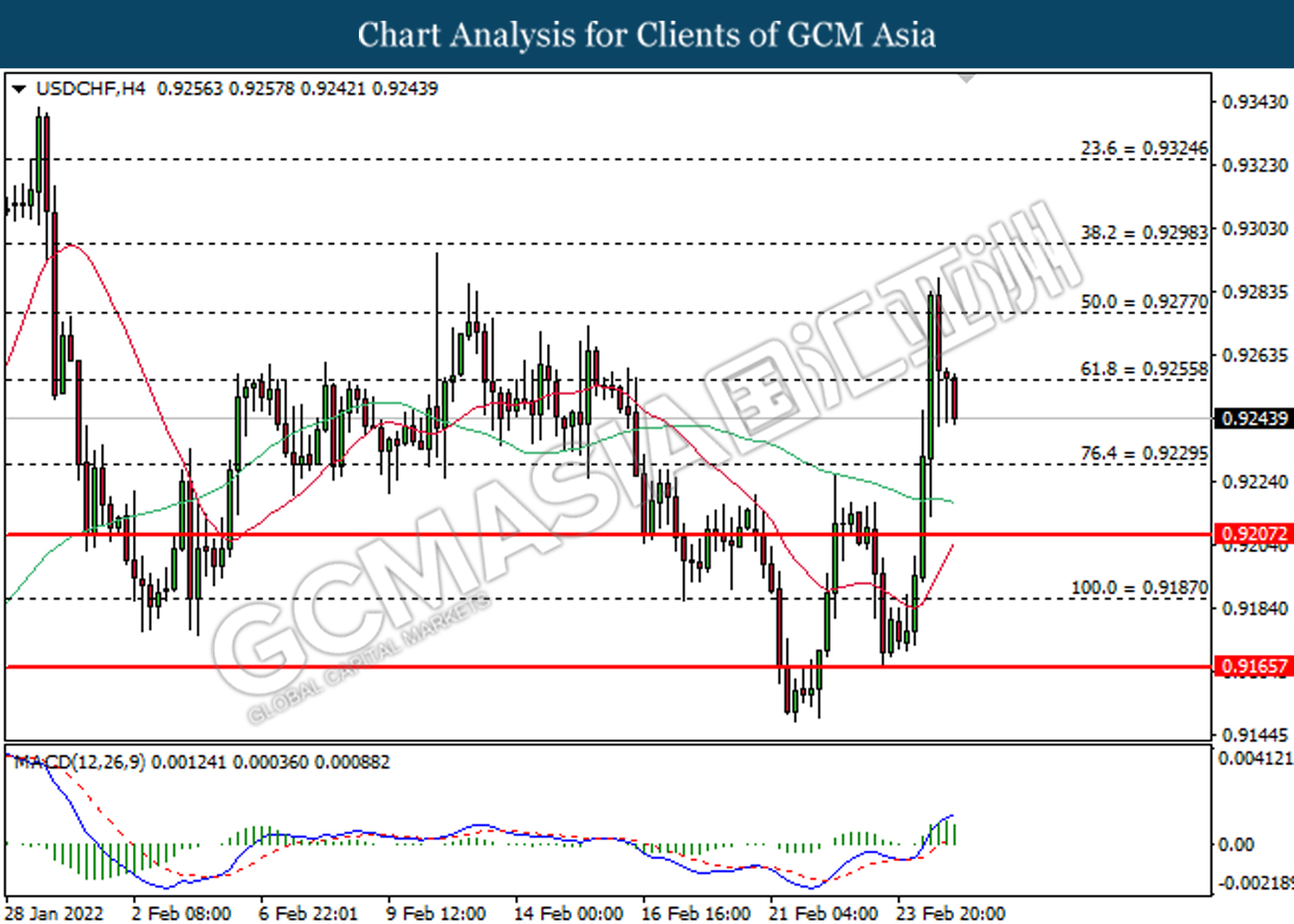

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bullish signal suggests its price to be traded higher in short-term.

Resistance level: 113.55, 120.00

Support level: 106.60, 99.50

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 1960.55, 1991.50

Support level: 1921.95, 1886.90

030322 Afternoon Session Analysis

03 March 2022 Afternoon Session Analysis

Aussie surged amid positive economic data.

The Australian Dollar surged over the backdrop of upbeat economic data yesterday, which dialled up the market optimism toward the economic progression in the Australia region. According to Australian Bureau of Statistics, Australia Gross Domestic Product (GDP) for last quarter notched up significantly from the previous reading of -1.9% to 3.4%, exceeding the market forecast at -2.7%. The primary driver of the positive reading was mostly due to high consumer spending rate following Covid-19 lockdown restrictions was eased. Nonetheless, the gains experienced by the Australia Dollar was limited by diminishing risk appetite in the global market. Market participants remained concerns that the rising tensions between Russia-Ukraine as well as rate hike from Federal Reserve would likely to trigger turbulence in the global economy. As of writing, AUD/USD surged 0.05% to 0.7290.

In the commodities market, the crude oil price appreciated by 1.78% to 114.85 per barrel as of writing. The crude oil price extends its gains following crude oil inventories data was released. According to Energy Information Administration (EIA), US Crude Oil Inventories data declined from the previous reading of 4.515M to -2.597M, better than the market forecast at 2.748M. On the other hand, the gold price appreciated by 0.06% to $1929.95 per troy ounces as of writing amid risk-off sentiment in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Feb) | 60.2 | 60.2 | – |

| 17:30 | GBP – Services PMI (Feb) | 60.8 | 60.8 | – |

| 21:30 | USD – Initial Jobless Claims | 232K | 226K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Feb) | 59.9 | 61.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.45. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 97.45, 98.95

Support level: 96.55, 95.65

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3355. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3440.

Resistance level: 1.3440, 1.3500

Support level: 1.3355, 1.3275

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1120. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1120, 1.1230

Support level: 1.1010, 1.0935

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 115.65. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7305. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7305, 0.7400

Support level: 0.7180, 0.7095

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2635. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2635, 1.2475

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9175. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9270.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 114.10. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 114.10, 117.90

Support level: 110.80, 106.20

GOLD_, H4: Gold price was traded lower while currently near the support level at 1919.30. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1946.30, 1971.50

Support level: 1919.30, 1888.35

030322 Morning Session Analysis

3 March 2022 Morning Session Analysis

ADP data pushes greenback forward.

Greenback continues to hover near 21 months high as investors shift their focus towards US jobs market data. According to ADP, Nonfarm Employment Change came in at 475K for last month, significantly higher than forecasted reading of 378K. The higher than expected reading was due to vast hiring in services sector, indicating resilient economy despite widespread transmission of Omicron variant. Likewise, the data has cemented investors expectation towards a more positive outcome from Nonfarm Payrolls report due tomorrow. Nonetheless, any substantial upside on the greenback was limited after Russia and Ukraine announced for another round of talks later today. The news has prompted higher demand for risky asset such as equities and bonds. As of writing, the dollar index was up 0.01% to 97.31.

As for commodities market, crude oil price was down by 0.69% to $110.75 per barrel following technical correction from the higher levels. On the other hand, gold price was down by 0.10% to $1,929.27 a troy ounce due to higher demand for risky assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Feb) | 60.2 | 60.2 | – |

| 17:30 | GBP – Services PMI (Feb) | 60.8 | 60.8 | – |

| 21:30 | USD – Initial Jobless Claims | 232K | 226K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Feb) | 59.9 | 61.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 1.3420, 1.3470

Support level: 1.3355, 1.3290

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1130, 1.1200

Support level: 1.1065, 1.0985

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7300, 0.7335

Support level: 0.7270, 0.7225

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6785, 0.6840

Support level: 0.6745, 0.6710

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2660, 1.2715

Support level: 1.2595, 1.2545

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 113.55, 120.00

Support level: 106.60, 99.50

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1960.55, 1991.50

Support level: 1921.95, 1886.90

020322 Afternoon Session Analysis

02 March 2022 Afternoon Session Analysis

Euro slumped amid rising tensions Russia-Ukraine.

The Euro extend its losses following the rising tensions between Russia-Ukraine had continue to jeopardize the overall economic momentum in the European region. According to Reuters, the Council of the European Union voted on Tuesday on sanctions to exclude Russian banks from SWIFT system to harm their ability to operate globally. Earlier, Russia warned Kyiv residents to flee their homes while Russian commanders have intensified the bombardment of Ukrainian cities. The Europe imports mostly 40% of its natural gas consumption and more than quarter demand for oil from Russia. The rising tensions between Russia-Ukraine as well as the implementation on sanction toward Russia would likely to increase the of raw materials for European countries, which leading to higher inflation risk in future while dragging down the appeal for Euro. As of writing, EUR/USD depreciated by 0.04% to 1.1121.

In the commodities market, the crude oil price surged 2.02% to 110.10 per barrel as of writing. The oil market edged higher over the backdrop of magnified tensions between Russian-Ukraine had continue to insinuate the oil supply concerns in future. On the other hand, the gold price appreciated by 0.05% to $1937.90 per troy ounces as of writing amid diminishing risk appetite in the global financial market had stoked a shift in sentiment toward safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Feb) | -48K | -23K | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.10% | 5.30% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | -301K | 350K | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.515M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.35. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 97.35, 98.20

Support level: 96.50, 95.75

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3355. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3275.

Resistance level: 1.3355, 1.3440

Support level: 1.3275, 1.3205

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1120. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1230, 1.1290

Support level: 1.1120, 1.1010

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 115.65.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7270. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2655. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 108.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.15, 114.10

Support level: 103.30, 97.35

GOLD_, H1: Gold price was traded lower while currently near the support level at 1929.40. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1946.30, 1958.20

Support level: 1929.40, 1919.30

020322 Morning Session Analysis

2 March 2022 Morning Session Analysis

War escalates although talks started.

War in between Russia and Ukraine escalates further even though both countries have kickstarted their negotiations on last Monday. According to Al Jazeera, several miles of Russian military convoy were seen near Ukraine’s capital Kyiv on yesterday. Russian government advanced through with their attack plans and reiterates that they will continue to do so until their “goals have been achieved”. On the other hand, US Treasury Secretary Janet Yellen announced that all members of G7 has agreed to setup a new task force in order to freeze and seize Russian owned assets. Likewise, Yellen also emphasized that they will enact new sanctions which targets Russia financially if the situation in Ukraine escalates further. Following risk aversion in the market, dollar index was up 0.01% to 97.34.

As for commodities market, crude oil price was up 1.54% to $106.45 per barrel due to escalating tension in between Russia and Ukraine which may disrupt global oil supply. On the other hand, gold price was up 0.10% to $1942.27 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Feb) | -48K | -23K | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.10% | 5.30% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | -301K | 350K | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.515M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.3355, 1.3420

Support level: 1.3290, 1.3220

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1135, 1.1200

Support level: 1.1080, 1.0985

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which diminished bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7270, 0.7300

Support level: 0.7225, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6840

Support level: 0.6745, 0.6710

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 106.60, 113.55

Support level: 99.50, 93.75

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1960.55, 1991.50

Support level: 1921.95, 1886.90

010322 Afternoon Session Analysis

01 March 2022 Afternoon Session Analysis

Australia Dollar surged following RBA statement.

The Australian Dollar surged following the Reserve Bank of Australia unleashed their hawkish tone toward the economic progression in Australia region. According to monetary policy statement from the Governor Philip Lowe, he claimed that the Monetary Policy Committee (MPC) decided to maintain the cash rate target at 10 basis points and the interest rate at zero per cent. He also reiterated that the Australian economy remains resilient while consumer spending is picking up following the Covid-19 cases waned. Despite the inflation has picked up more quickly than the central bank expectation, but it still remains lower than in many other countries. Though, the war between Ukraine and Russia is a major new source of uncertainty, hence the Monetary Policy Committee (MPC) will still continue to monitor the situation in order to decide the implementation of monetary policy decision in future. As of writing, AUD/USD appreciated by 0.05% to 0.7255.

In the commodities market, the crude oil price surged 0.68% to $97.85 per barrel as of writing. The oil market edged higher amid rising tensions between Russia-Ukraine had continue to insinuate concerns upon the supply disruption in future. On the other hand, the gold price depreciated by 0.25% to $1904.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 58.5 | 58.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | 57.3 | – |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.60% | 0.10% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 57.6 | 58 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 96.50. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 97.35, 98.20

Support level: 96.50, 95.75

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3440. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3440, 1.3500

Support level: 1.3355, 1.3275

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1230. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.1125.

Resistance level: 1.1230, 1.1290

Support level: 1.1125, 1.1010

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 115.65. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2655. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 96.50. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.50, 98.05

Support level: 94.75, 93.05

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level at 1910.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1888.35.

Resistance level: 1910.80, 1929.40

Support level: 1888.35, 1870.15

010322 Morning Session Analysis

1 March 2022 Morning Session Analysis

Russia-Ukraine talk held.

Market participants began to shift their capital into risky assets after Russia and Ukraine agreed to hold talks on yesterday. The talk which is held near Poland-Belarus border discussed the possibility of achieving peace with certain criteria which are being requested from both parties. Ukrainian government requested for an immediate cease fire and Russia will be required to recall their troops from their country. At the same time, Russia also requires a guarantee of Ukraine’s neutrality in global politics as well as withdrawing their application to join NATO. According to head of Russian delegation Vladimir Medinsky, he commented that both parties have agreed upon several requests that were being discussed. Although a peace agreement has not yet been solidified, Medinsky expresses his confidence to achieve it in the near future and both countries is set to meet again in the next few days. Following lower risk of escalation in Russia-Ukraine war, the dollar index was down 0.01% to 96.64.

In the commodities market, crude oil price was down 0.31% to $95.71 per barrel following possible peace agreement in between Russia and Ukraine. On the other hand, gold price was down 0.13% to $1907.39 a troy ounce due to higher demand for risky assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Mar) | 0.10% | 0.10% | – |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 58.5 | 58.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | 57.3 | – |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.60% | 0.10% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 57.6 | 58 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 1.3420, 1.3470

Support level: 1.3355, 1.3290

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1270, 1.1340

Support level: 1.1200, 1.1135

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which diminished illustrate bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7270, 0.7300

Support level: 0.7225, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6840

Support level: 0.6745, 0.6710

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2595

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 96.30, 100.00

Support level: 93.15, 91.00

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10

280222 Afternoon Session Analysis

28 February 2022 Afternoon Session Analysis

Escalating tensions Russia-Ukraine, spurring demand on safe-haven Japanese Yen.

The rising tensions between Russia-Ukraine recently had spurred further risk-off sentiment in the global financial market, which prompting investors to shift their portfolio toward safe-haven asset while insinuating bullish momentum on the Japanese Yen. According to Reuters, the most recent sanctions from European countries will ban Russian lenders from using the global SWIFT messaging system, while raising concerns upon the ability for Central Bank of the Russian Federation ability to stabilize the Russian financial system. Nonetheless, Russian and Ukraine officials will meet at the border with Belarus, but Ukrainian President Volodymyr Zelenskiy remained sceptical about the talks between both countries. Though, as of writing investors would continue to scrutinize the latest updates with regards of war prospect between Russia-Ukraine to receive further trading signal. As of writing, USD/JPY depreciated by 0.05% to 115.45.

In the commodities market, the crude oil price appreciated by 4.41% to $97.55 per barrel as of writing. The crude oil price jumped significantly amid escalating sanctions against Russia over its invasion of Ukraine had increased concerns upon the supply disruption in future. On the other hand, the gold price appreciated by 1.08% to $1909.65 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.35. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 97.35, 98.20

Support level: 96.50, 95.75

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.3355. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3440, 1.3500

Support level: 1.3355, 1.3275

EURUSD, H1: EURUSD was traded lower while currently near the support level at 1.1125. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1230, 1.1290

Support level: 1.1125, 1.1010

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 115.65. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6715. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6535.

Resistance level: 0.6715, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2800. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2800, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently near the support level at 95.45. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 98.05, 100.15

Support level: 95.45, 93.05

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1906.90. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1929.40, 1946.30

Support level: 1906.90, 1888.35

280222 Morning Session Analysis

28 February 2022 Morning Session Analysis

Will Russia use nuclear weapon?

Investors were being shaken with latest developments from Russian and Ukrainian war as the former contemplates to use nuclear weapon. According to Reuters, Russian President Vladimir Putin has ordered its nuclear deterrence force to stay on high alert as the war escalates to the next level. His latest order has received wide condemnation from leaders in the West, citing the call will bring the world to witness yet another nuclear war if it is being used. Likewise, investors are currently speculating more sanctions being introduced towards Russia as previously announced sanctions failed to deter Russia from advancing further into attacking Ukraine. The announcement has also sparked risk aversion in the market, prompting higher demand for safe-haven assets in the financial market. As of writing, the dollar index was up 0.15% to 96.60.

In the commodities market, crude oil price was up 5.02% to $97.13 per barrel following rising tensions in between Russia and Ukraine. On the other hand, gold price was up 0.79% to $1,905.00 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3410, 1.3470

Support level: 1.3355, 1.3290

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lowr in short-term.

Resistance level: 1.1200, 1.1270

Support level: 1.1135, 1.1080

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9280, 0.9300

Support level: 0.9255, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 100.00, 103.20

Support level: 96.30, 93.15

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10

250222 Afternoon Session Analysis

25 February 2022 Afternoon Session Analysis

Euro rebounded amid technical correction, eyed on tensions between Russia-Ukraine.

The Euro rebounded following significant sell-off on yesterday amid technical correction. Nonetheless, the overall trend for the pair of Euro still remained uncertainty while investors would still need to maintain their focus toward the prospect of the relationship between Russia-Ukraine to receive further trading signal. In earlier, Russia unleashed their biggest attack on a European state since World War Two, causing tens of thousand of people flee their homes. According to the Guardian, European countries had decided to imposed sanctions on 27 individuals and entities on Russia. Besides, restrictions on access to Europe’s capital market have been imposed, in particular by prohibiting the financing of Russia, its government and its central Bank. Several policymakers at European Central Bank (ECB) had said the situation in Ukraine could cause the ECB to slowdown its contractionary monetary policy in future. As of writing, EUR/USD appreciated by 0.21% to 1.1215.

In the commodities market, the crude oil price appreciated by 2.62% to 97.05 per barrel as of writing. The oil market edged higher amid rising tensions between Russia-Ukraine had spurred concerns toward the oil supply disruption in future. On the other hand, the gold price appreciated by 0.52% to $1913.85 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q4) | -0.70% | -0.70% | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | 0.60% | 0.40% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | -3.80% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 97.35. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 97.35, 98.20

Support level: 96.00, 94.55

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.3340. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3500, 1.3615

Support level: 1.3340, 1.3215

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1125. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1290.

Resistance level: 1.1290, 1.1380

Support level: 1.1230, 1.1010

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 115.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 114.30.

Resistance level: 115.65, 116.25

Support level: 114.30, 113.65

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level at 0.7205. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6685. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.7050

Support level: 0.6685, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2795. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2795, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 95.90. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 95.90, 98.05

Support level: 93.05, 88.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1946.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1946.03, 1971.50

Support level: 1912.35, 1870.15

250222 Morning Session Analysis

25 February 2022 Morning Session Analysis

New US sanction upon Russia.

Greenback rebounds from its lower level while investors reassess US sanction against Russia and its impact towards the global economy. In a statement, US President Joe Biden announced several sanctions which includes restricting international transaction of 5 major Russian banks, freezing of Russian owned asset in the US as well as halting the process of technological export into Russia for the means of military and industrial upgrades. The latest sanction from the US excludes targeting Russia in terms of crude oil exports. The latest measure, as proclaimed by economists, does not pose great impact towards the global economy as it scrutinizes mainly on Russian economy. Thus, investors reassess their portfolio and shift towards risky assets in the market such as equities. Nonetheless, the demand for US dollar remains high as investors speculate Federal Reserve to tighten monetary policy at a faster pace throughout the year. As of writing, the dollar index was up 0.01% to 97.03.

As for commodities market, crude oil price rebounds by 1.04% to $94.31 per barrel. Oil futures received tremendous selloff on yesterday night after US latest sanction fails to target Russian oil export. On the other hand, gold price rose 0.33% to $1,904.30 a troy ounce following prior technical correction from its higher level.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q4) | -0.70% | -0.70% | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | 0.60% | 0.40% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | -3.80% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3410, 1.3470

Support level: 1.3355, 1.3290

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1200, 1.1270

Support level: 1.1135, 1.1080

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2835, 1.2910

Support level: 1.2785, 1.2715

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 96.30, 99.20

Support level: 93.15, 91.00

GOLD_, H1: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10

240222 Afternoon Session Analysis

24 February 2022 Afternoon Session Analysis

Safe-haven currencies surged amid rising tensions Russia-Ukraine.

The safe-haven asset such as Japanese Yen and Swiss France surged significantly over the backdrop of risk-off sentiment in the global financial market following Russian President Vladimir Putin authorised a military operation in eastern Ukraine on Thursday. Explosion rocked the breakaway eastern Ukrainian city of Donetsk and civilian aircraft were warned away as the United States claimed a major attack by Russia on Ukraine was imminent. Currently, a total of 80% of Russian soldiers assembled are in a position to launch a full-scale invasion on Ukraine, according to senior US defence official. The rising tensions between Ukraine-Russia would be spurring geopolitics risk to the global, which stoked a shift in sentiment toward safe-haven asset. As of writing, USD/JPY depreciated by 0.20% to 114.75 while USD/CHF dived 0.05% to 0.9175.

In the commodities market, the crude oil price surged 2.60% to 96.35 per barrel as of writing. The oil market edged higher amid market participants concerned that the rising tensions between Russia-Ukraine would increase further uncertainty for the oil supply in future, insinuating bullish momentum on the crude oil price. On the other hand, the gold price appreciated by 1.05% to $1927.80 per troy ounces.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – GDP (QoQ) (Q4) | 6.90% | 7.00% | – |

| 21:30 | USD – Initial Jobless Claims | 248K | 235K | – |

| 23:00 | USD – New Home Sales (Jan) | 811K | 807K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 96.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.80, 97.50

Support level: 96.00, 94.55

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3500. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3615, 1.3730

Support level: 1.3500, 1.3440

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1230. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1290, 1.1380

Support level: 1.1230, 1.1125

USDJPY, H4: USDJPY was traded lower while currently near the support level at 114.30. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6715. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2780. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 95.90. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 98.05.

Resistance level: 98.05, 100.15

Support level: 93.05, 88.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1946.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1946.03, 1971.50

Support level: 1912.35, 1870.15

240222 Morning Session Analysis

24 February 2022 Morning Session Analysis

US begins to sanction Russia.

Greenback remains well supported from its lower levels as tension in between Russia and Ukraine rises to a new height. According to Al Jazeera, Washington stated that Russian troops along the Ukrainian border may strike at any time. Satellite imagery shows that more than 80% out of 150,000 troops are currently on stand-by mode. On the other hand, US President Joe Biden has announced the enactment on sanction upon a natural gas pipeline Nord Stream 2 which links Russia and Germany. Sanction upon the $11 billion infrastructure project is one of the moves taken by US in order to reduce the risk of war in between Russia and Ukraine. However, economists believe that the sanction may do more harm towards Germany than Russia as the former consumes more than 27% of natural gas that were being delivered to them. As of writing, the dollar index was up 0.02% to 96.14.

As for commodities market, crude oil price rose 0.43% to $92.69 per barrel due to rising tension in between Russia and Ukraine. Likewise, gold price rose 0.07% to $1910.43 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – GDP (QoQ) (Q4) | 6.90% | 7.00% | – |

| 21:30 | USD – Initial Jobless Claims | 248K | 235K | – |

| 23:00 | USD – New Home Sales (Jan) | 811K | 807K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7270, 0.7300

Support level: 0.7225, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6840

Support level: 0.6745, 0.6710

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10

230222 Afternoon Session Analysis

23 February 2022 Afternoon Session Analysis

New Zealand Dollar surged following rate hike decision.

The New Zealand Dollar surged following the New Zealand’s central bank unleashed their hawkish tone toward the economic momentum, which raising their interest rates back to pre-pandemic levels and signalling the possibility of aa more aggressive contractionary monetary path in order to combat the rising inflationary risks. The Monetary Policy Committee (MPC) had voted to a 25-basis point interest hike in the official cash rate (OCR) to 1.0%. Faced with global supply-chain issues and increasingly tight labour market, the Reserve Bank of New Zealand (RBNZ) is struggling to contain inflationary pressures. With the inflation rate hitting a three-decade high of 5.9% for last quarter, economists have priced in more hikes in the year of 2022. Nonetheless, the uncertainties remain over the outlook as the Omicron variant spreads more rapidly through New Zealand and rising tensions between Russia-Ukraine. As of writing, NZDU/USD appreciated by 0.45% to 0.6761.

In the commodities market, the crude oil price surged 0.57% to 93.80 per barrel as of writing. The oil market extends its gains amid market participants concerned that the rising geopolitical tensions between Russia-Ukraine would disrupt the oil supply in future. On the other hand, the gold price appreciated by 0.03% to $1899.15 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 GBP Inflation Report Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 5.00% | 5.10% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 96.00. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.00, 9.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3515. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3615, 1.3730

Support level: 1.3505, 1.3440

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1290. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.30. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 115.40.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7205. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7270.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2780. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9175. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9270.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 93.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 91.50

Resistance level: 93.05, 94.55

Support level: 90.60, 88.50

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level at 1910.90. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1887.60.

Resistance level: 1910.90, 1923.35

Support level: 1887.60, 1870.15