230222 Morning Session Analysis

23 February 2022 Morning Session Analysis

US-Russia summit may be called off.

Demand for safe-haven asset remains high in the financial market following recent developments with regards to Russia and Ukraine tension. On yesterday, US Secretary Antony Blinken announced that he will not be meeting with Russia Foreign Minister Sergey Lavroy as scheduled. Following the announcement, White House stated that the summit in between both US and Russian president is rather unlikely, given the circumstances and recent events. However, White House declared that they are still open for discussion but it is not the right time as of recent. Previously, Russia President Vladimir Putin as signed a decree to recognize independence of two Ukrainian regions which are controlled by separatist. Following the decree, satellite images showed that Russia has mobilized its troops towards the two regions, sparking concern over an attack towards Ukraine at any point of time. As of writing, the dollar index was up 0.01% to 96.02.

In the commodities market, crude oil price was down by 0.03% to $91.51 per barrel as market participants waits for official inventory data from Energy Information Administration. On the other hand, gold price was traded flat at $1,898.53 a troy ounce while waiting for more signals with regards to Russia-Ukraine tensions.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 GBP Inflation Report Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 5.00% | 5.10% | – |

Technical Analysis

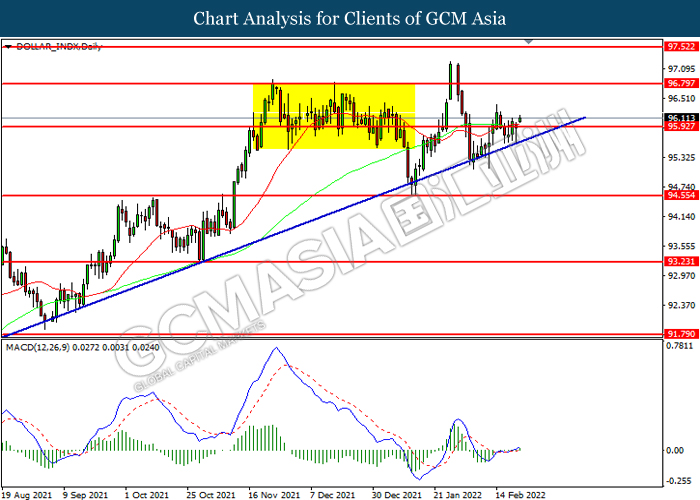

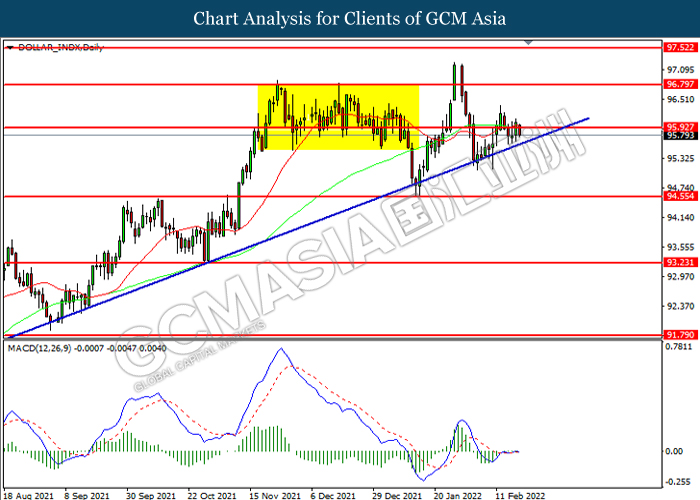

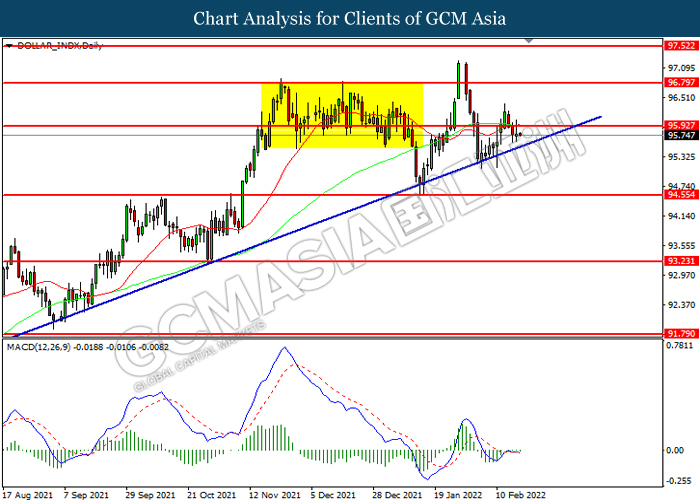

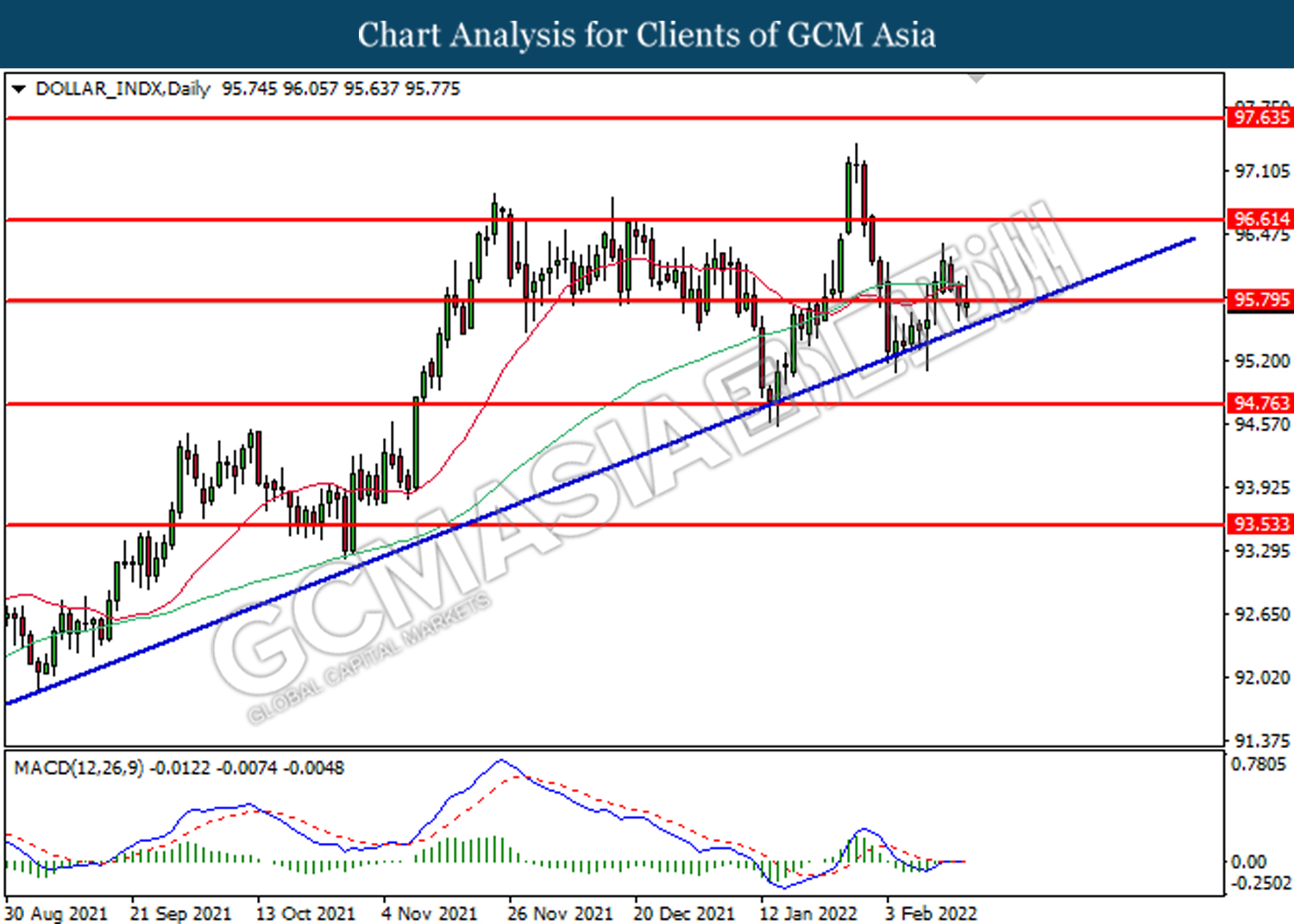

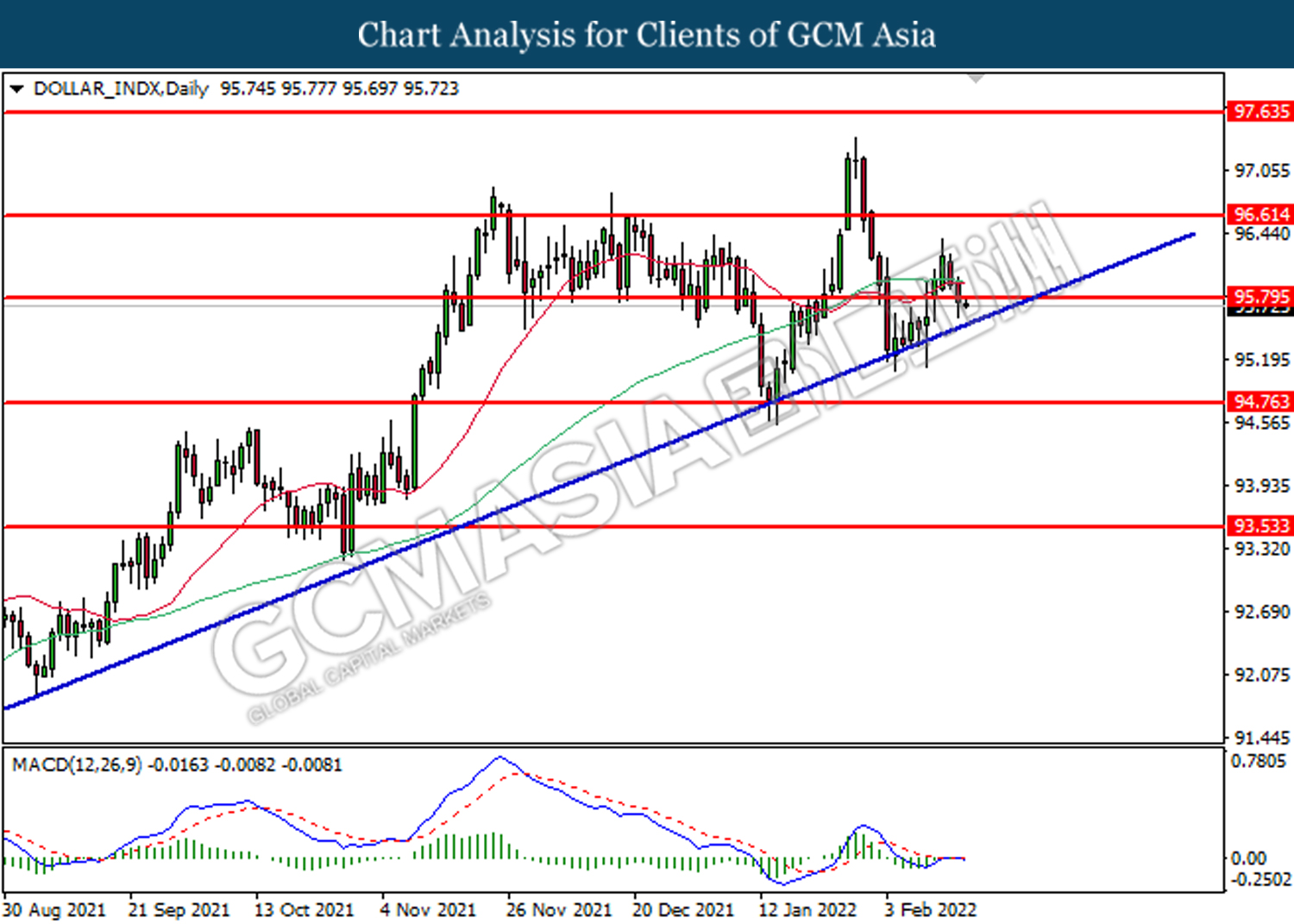

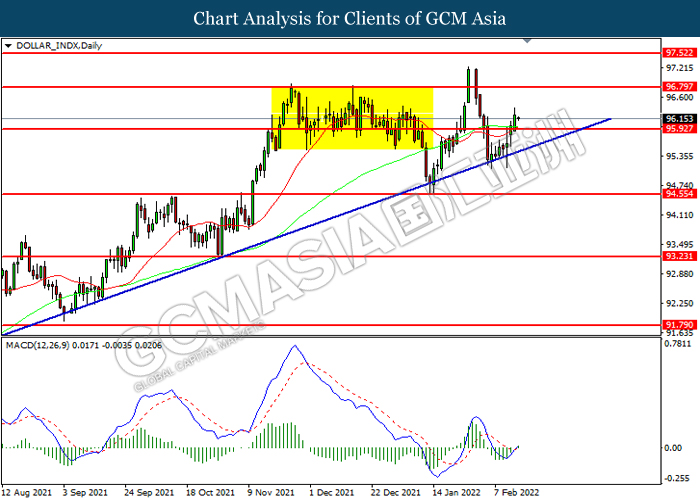

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

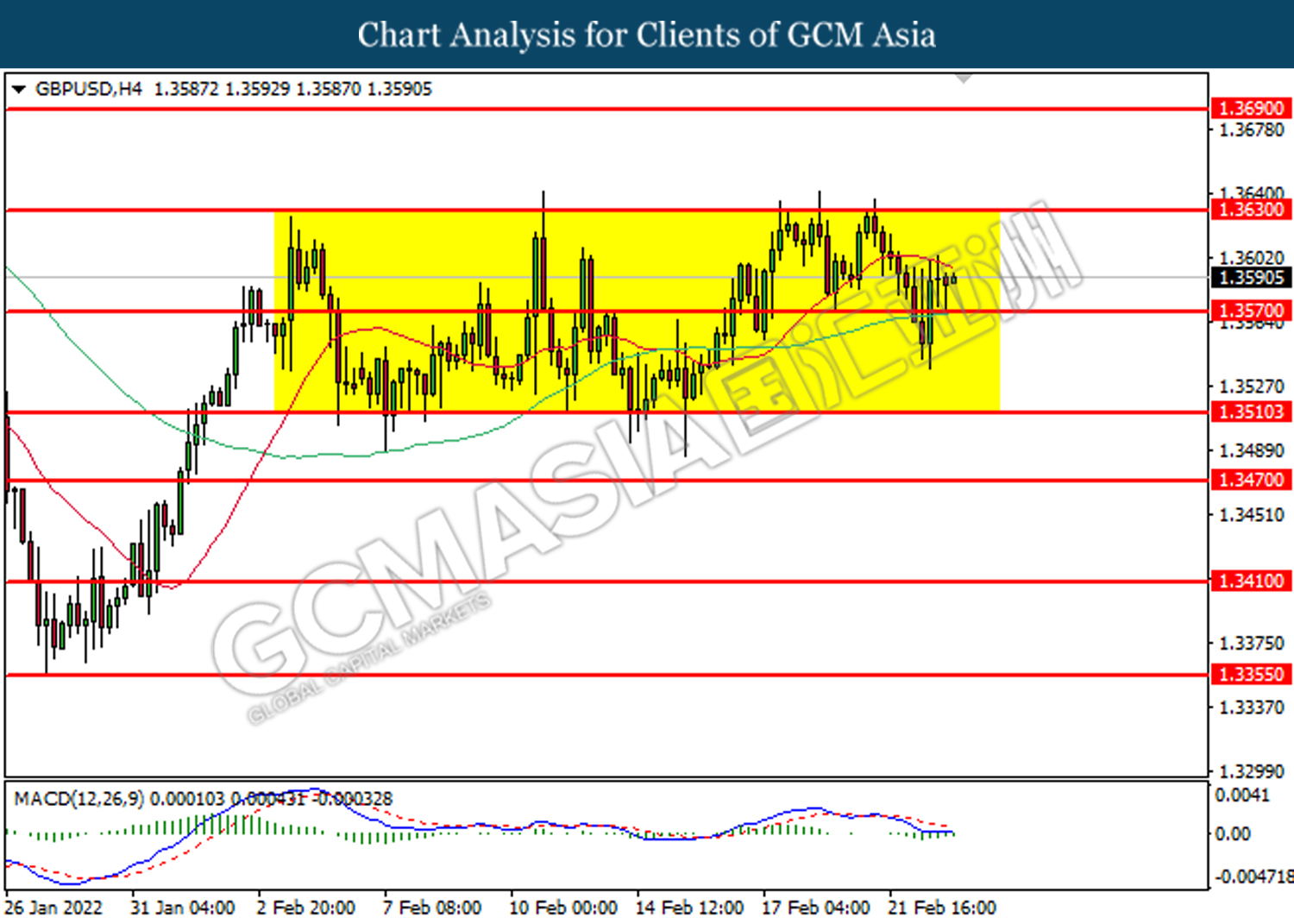

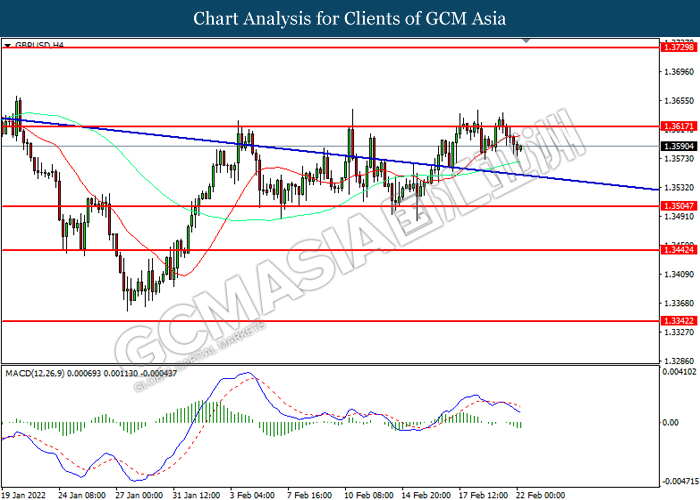

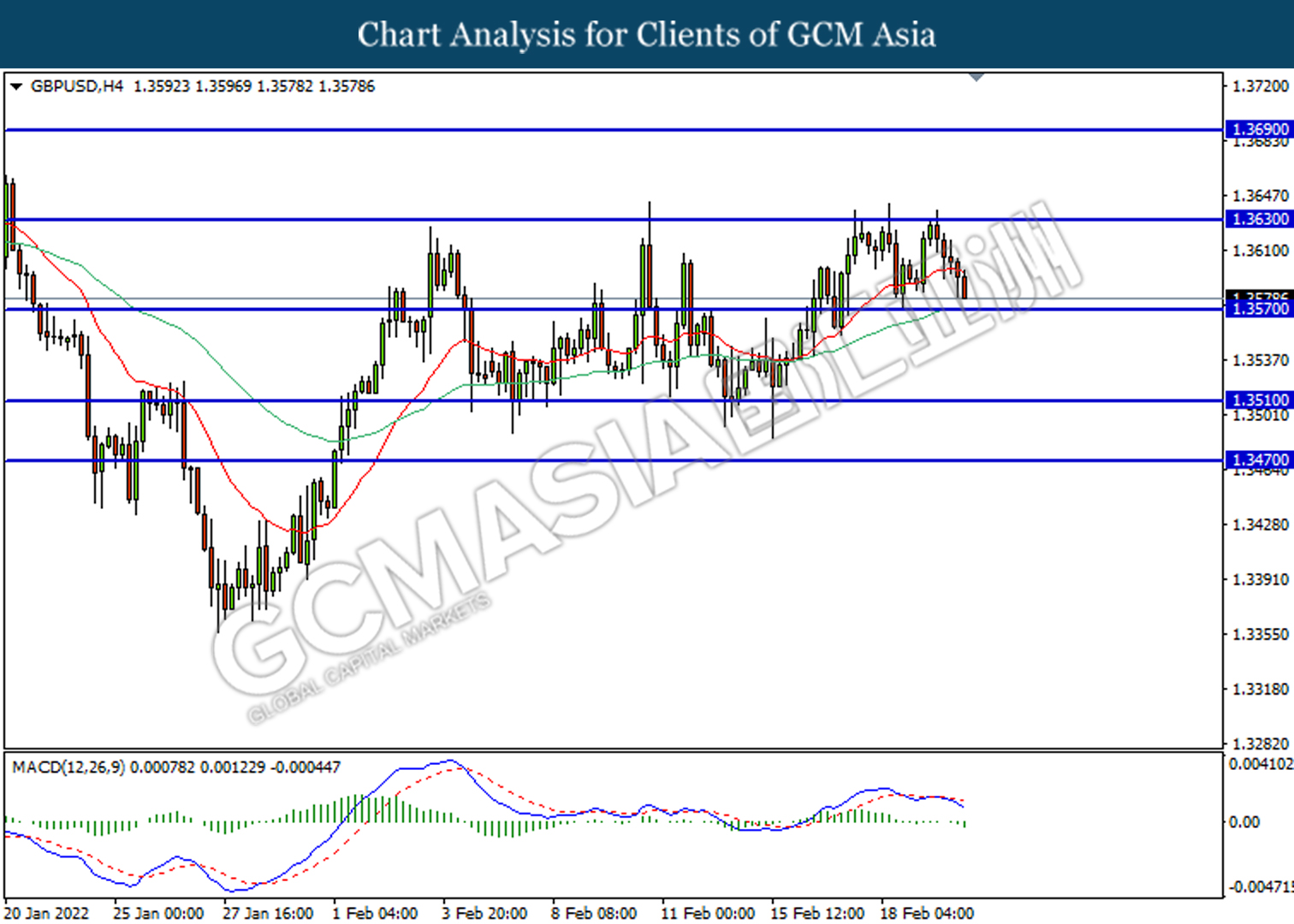

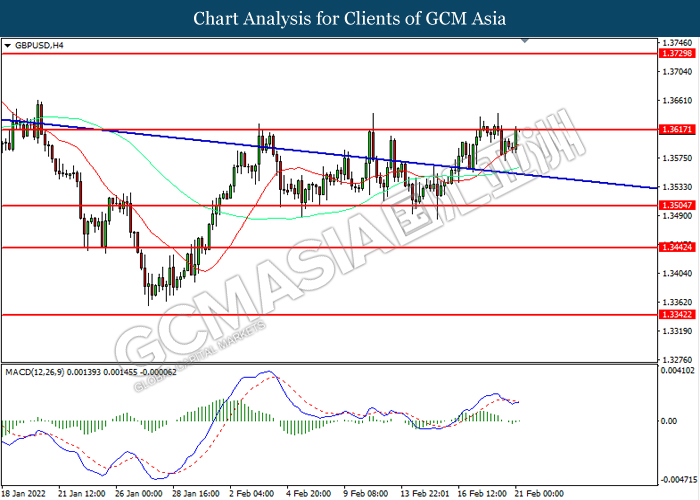

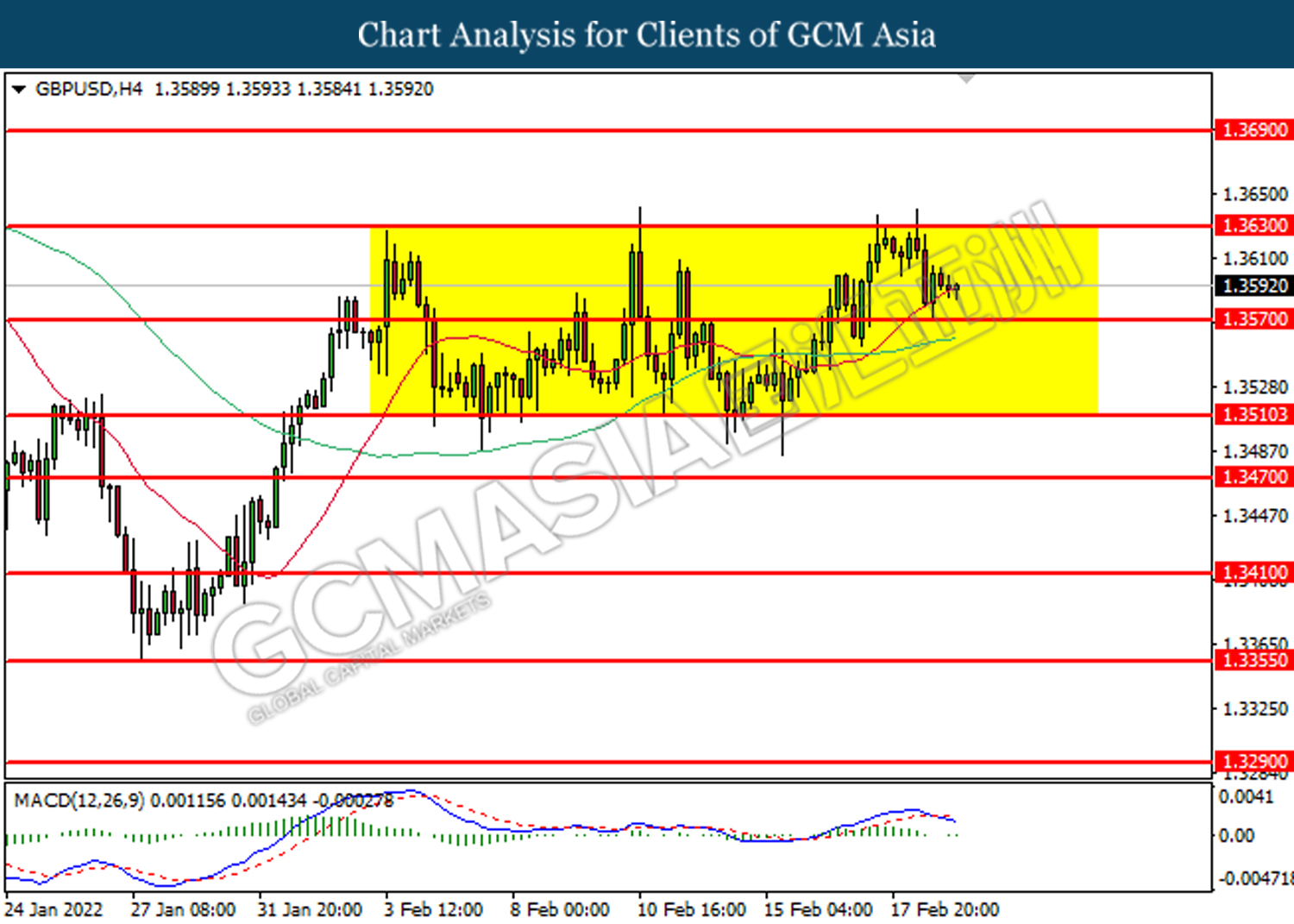

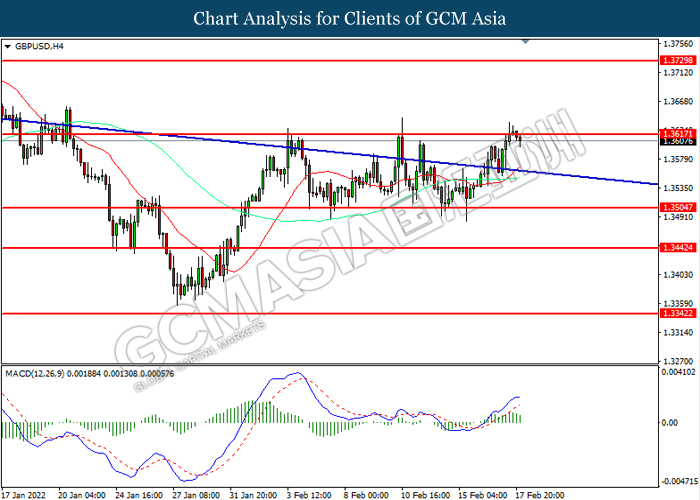

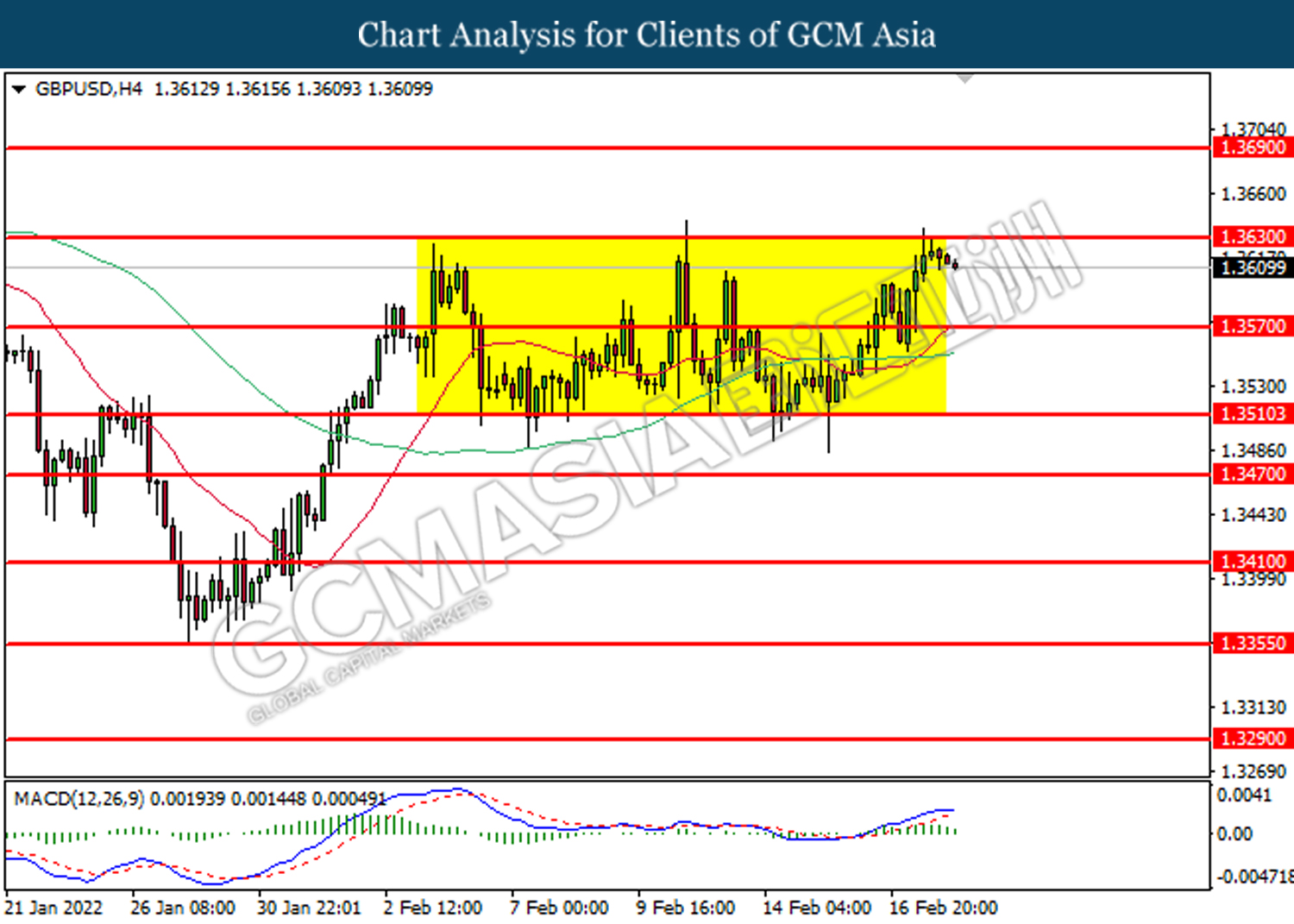

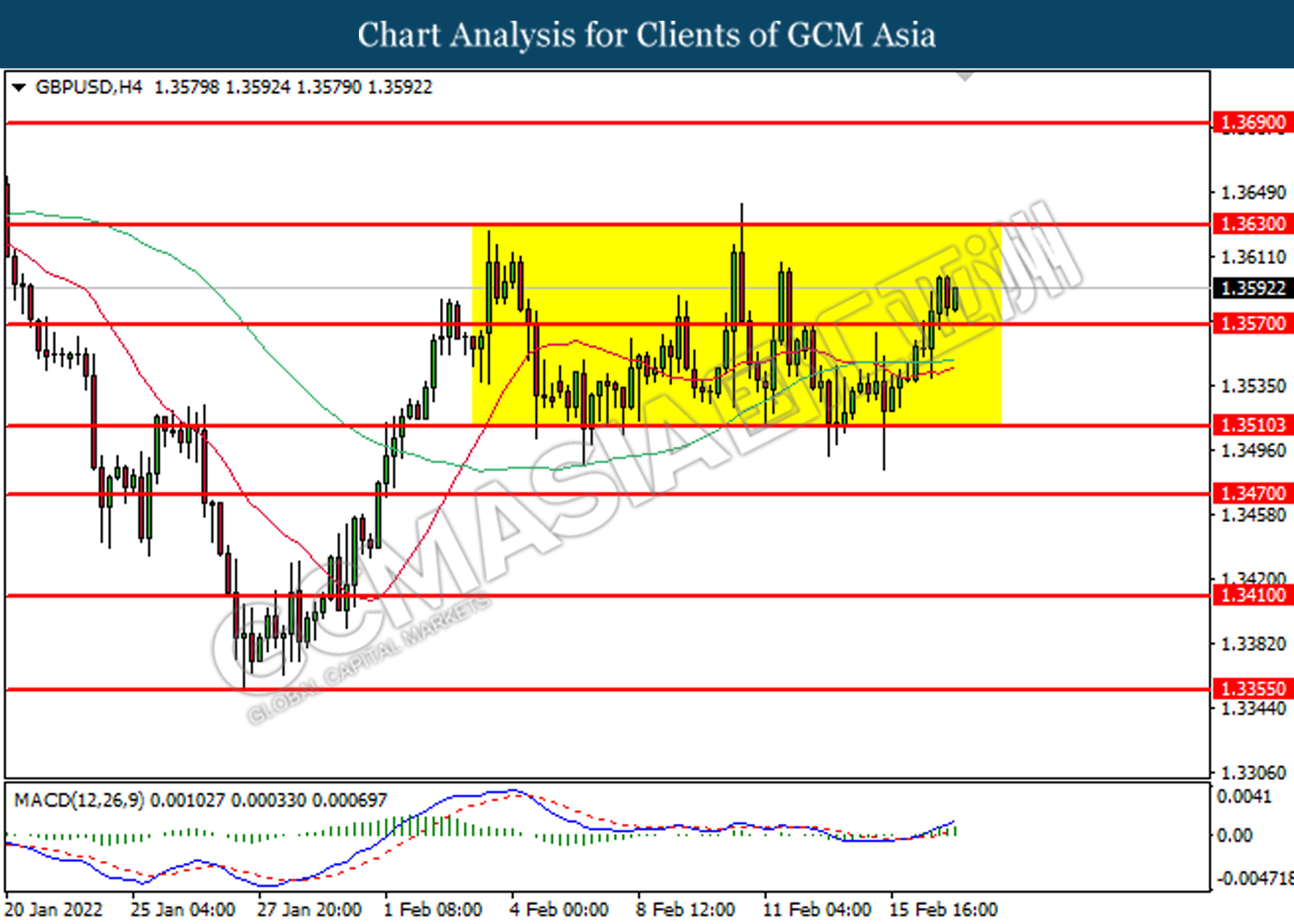

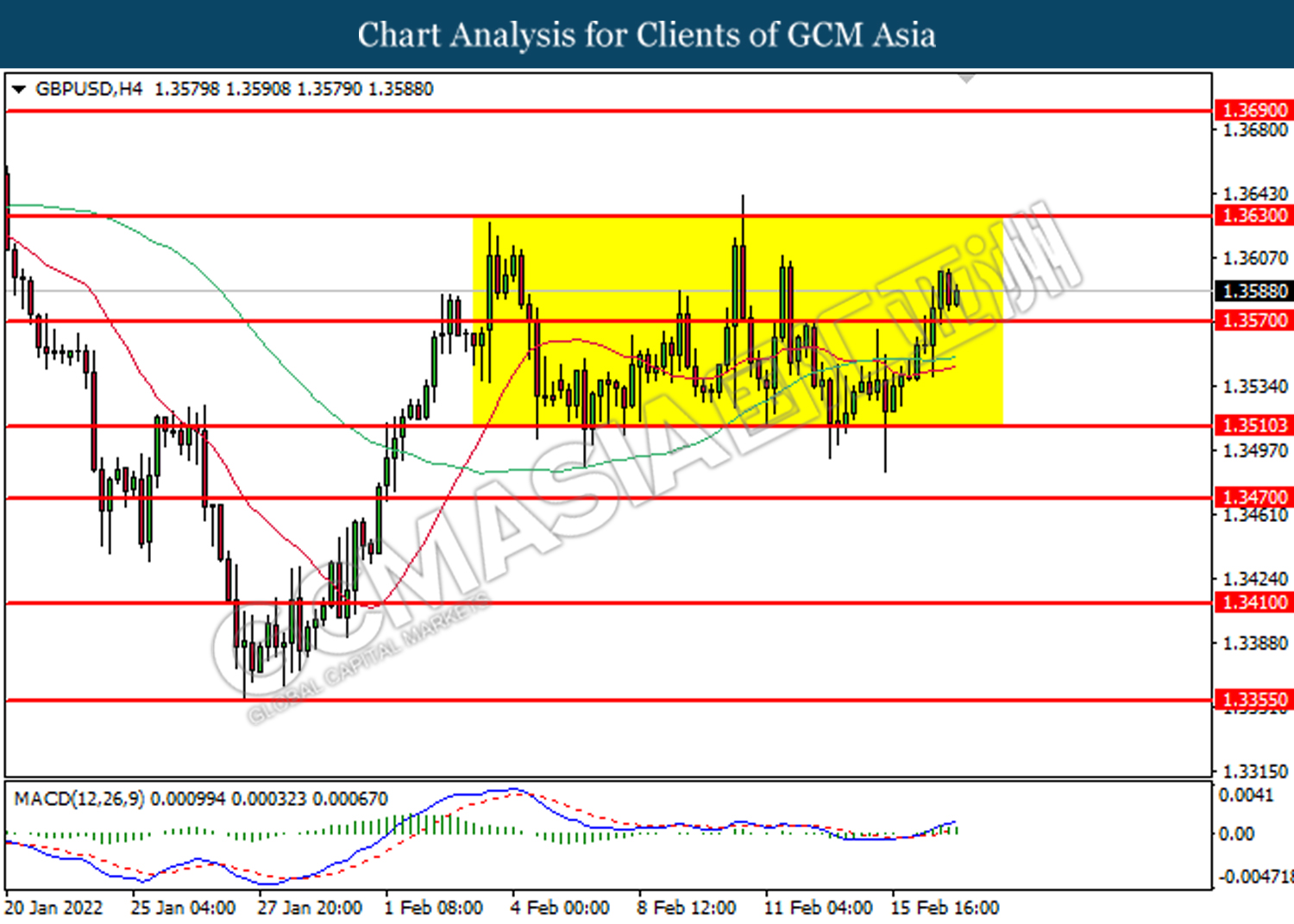

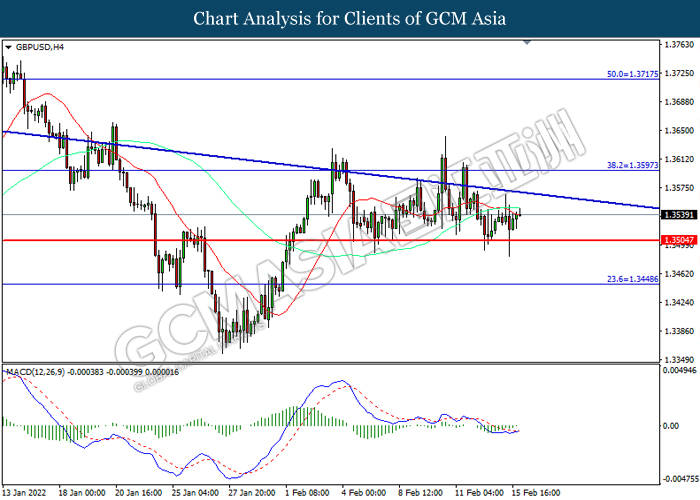

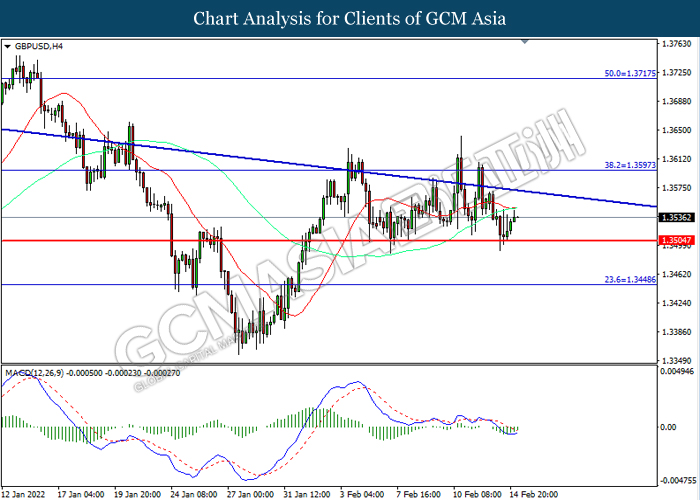

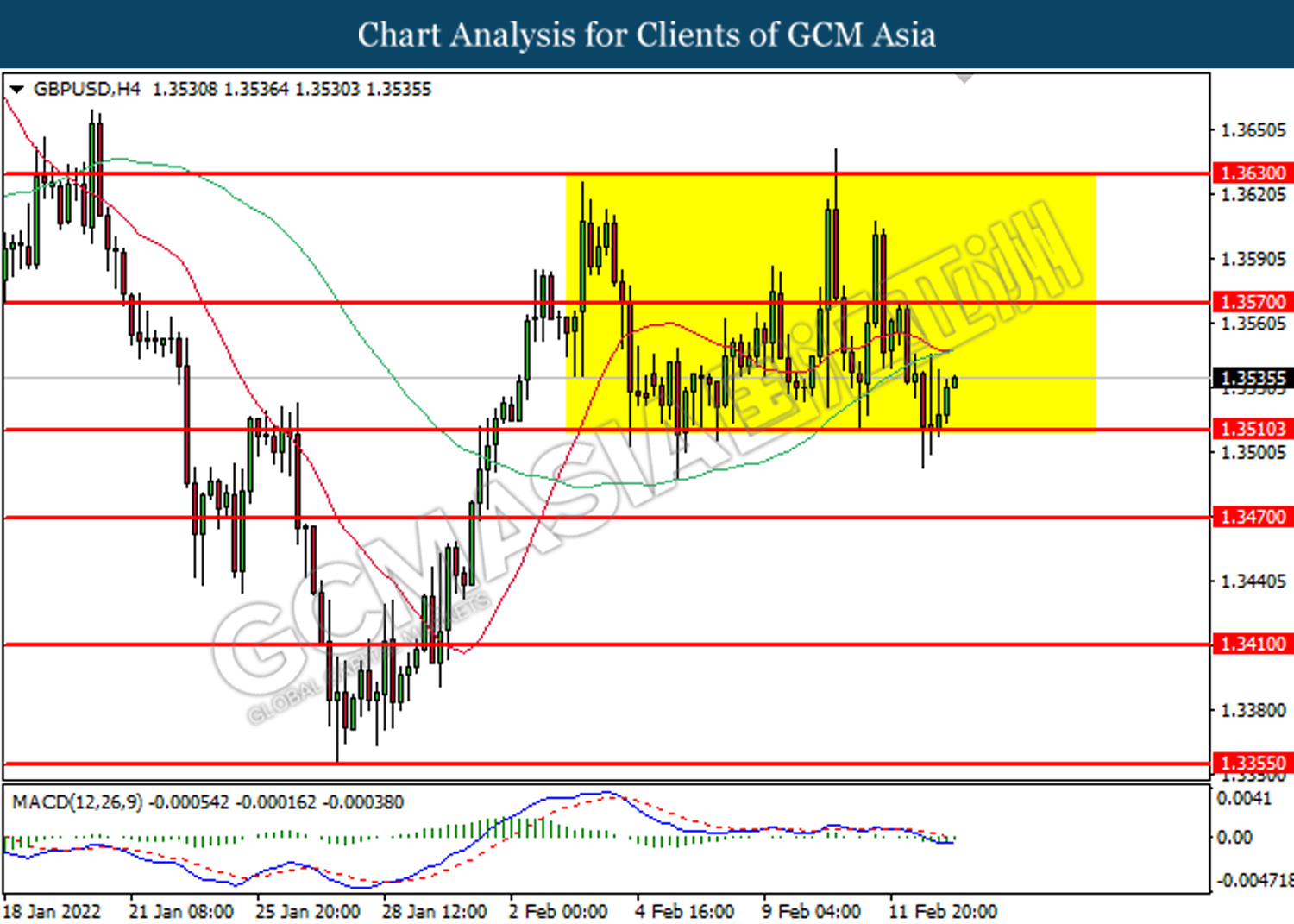

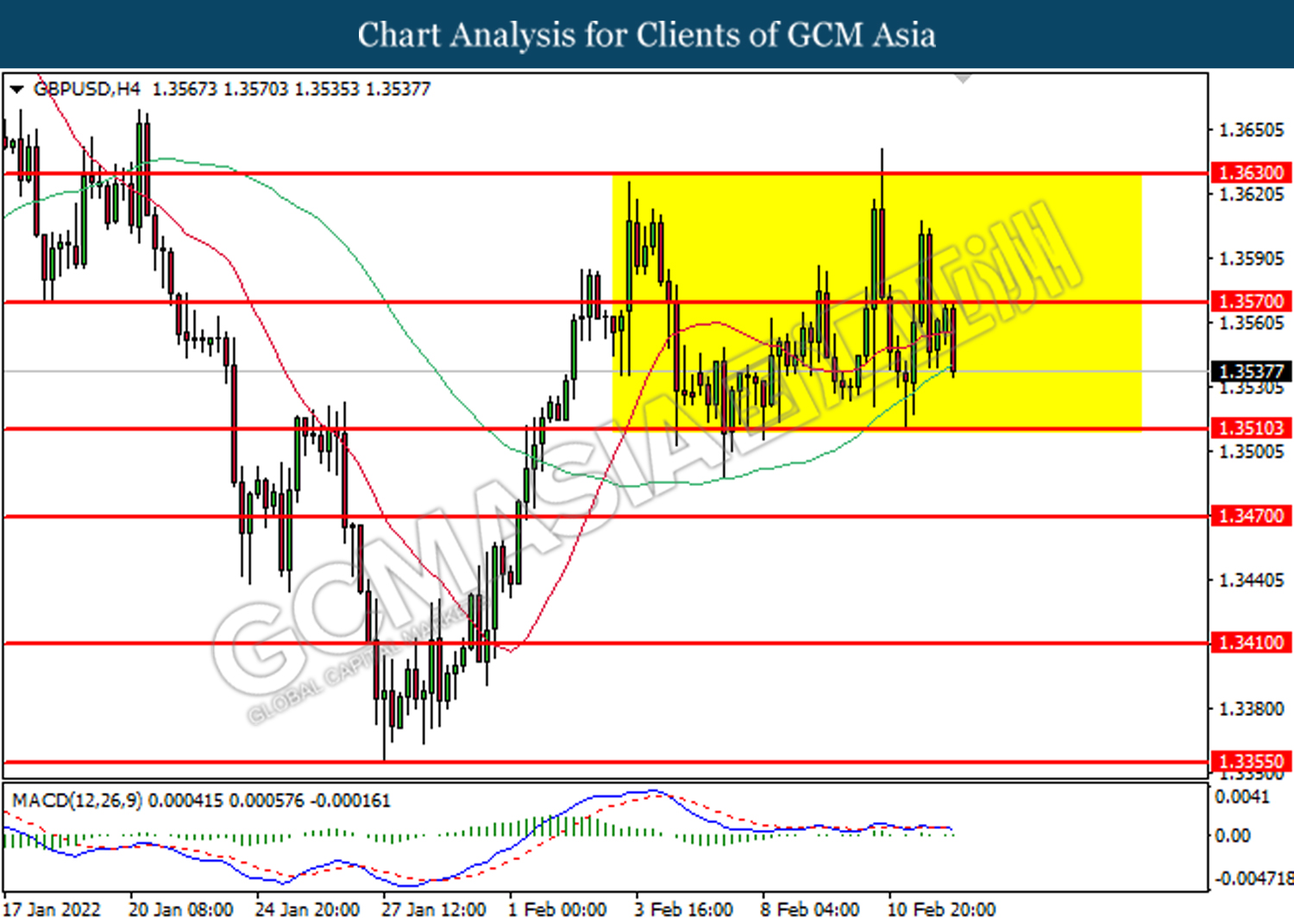

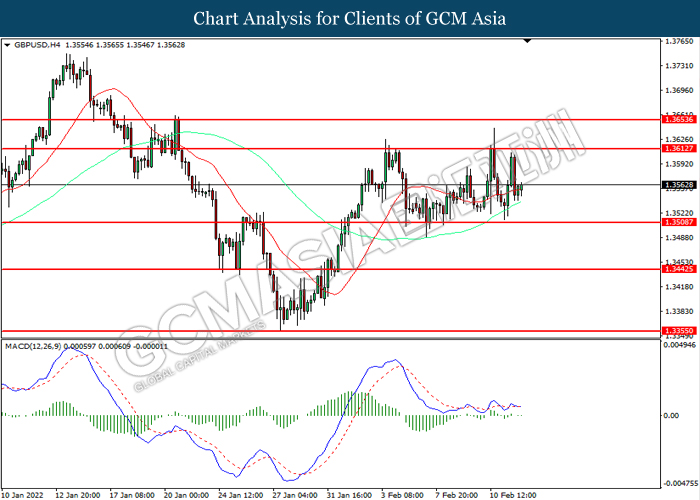

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

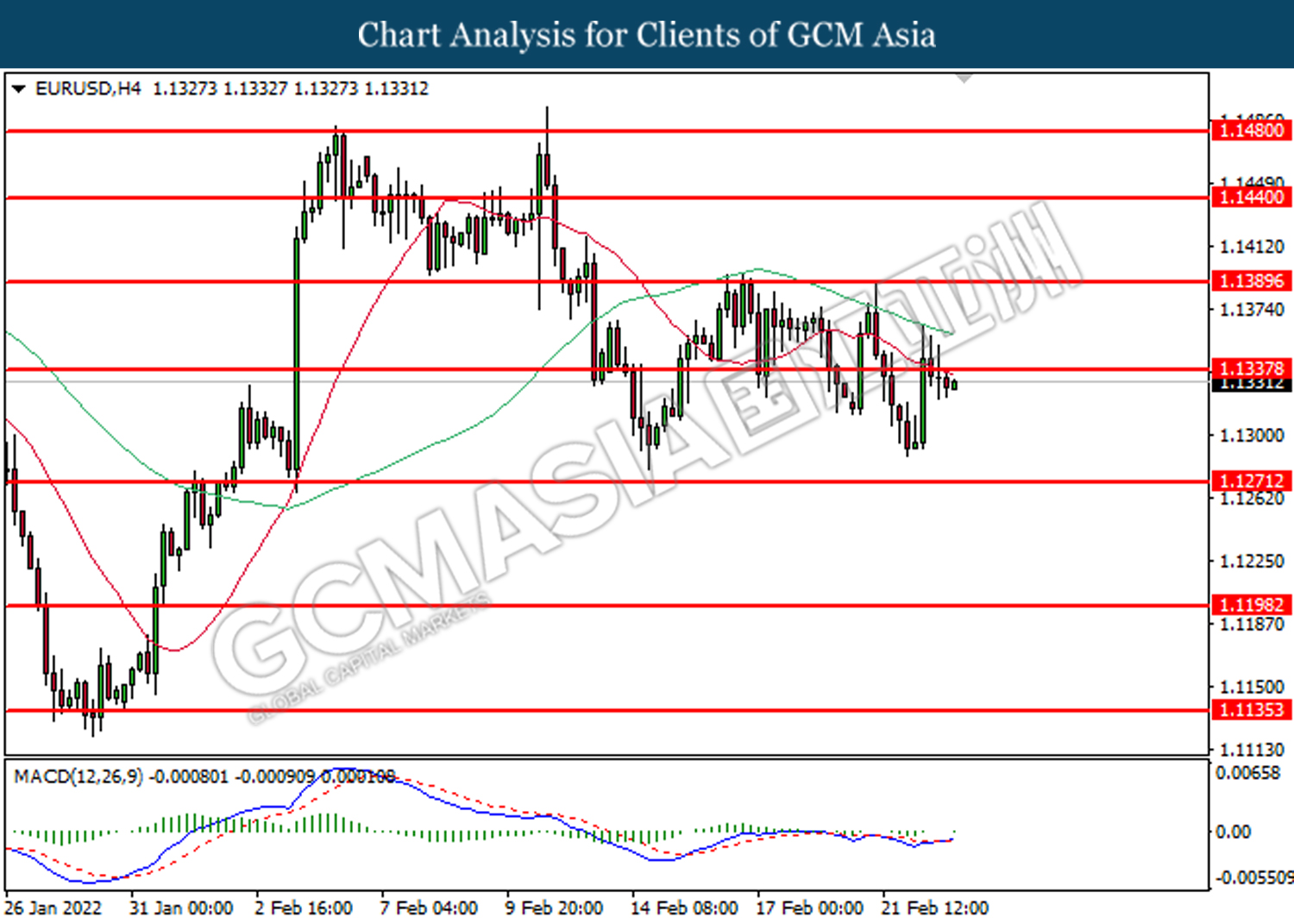

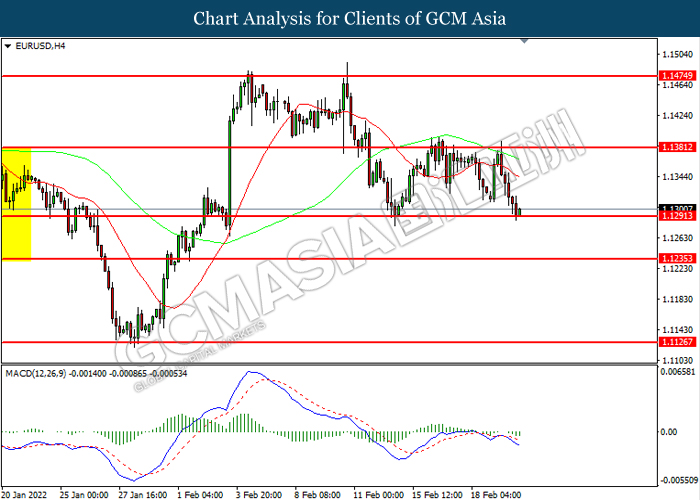

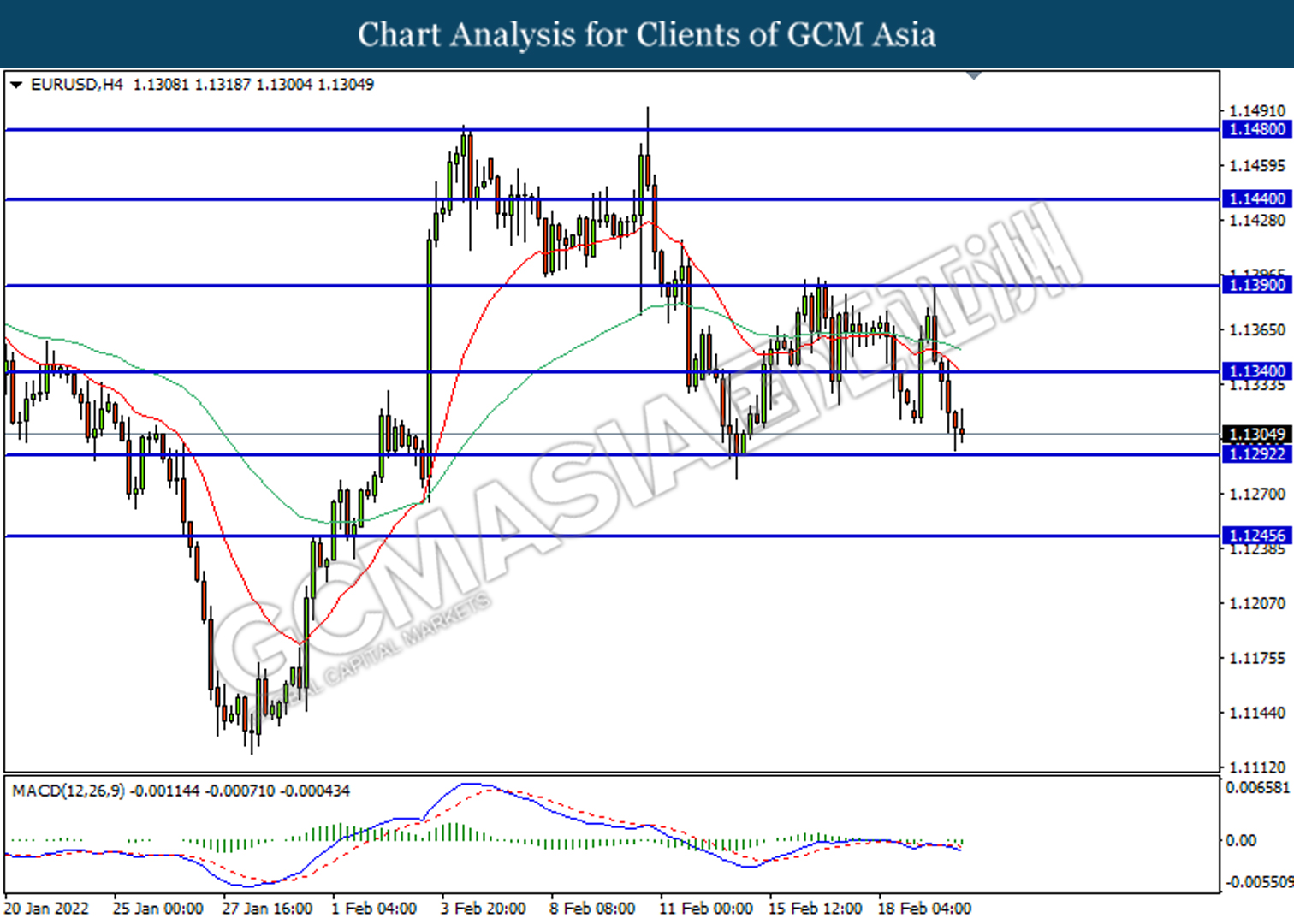

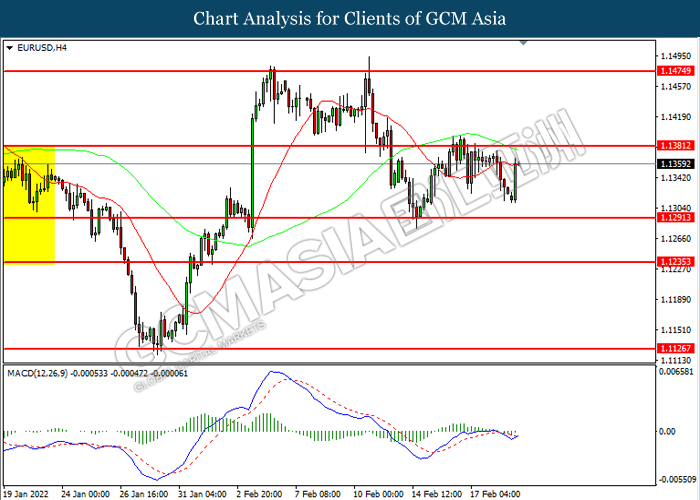

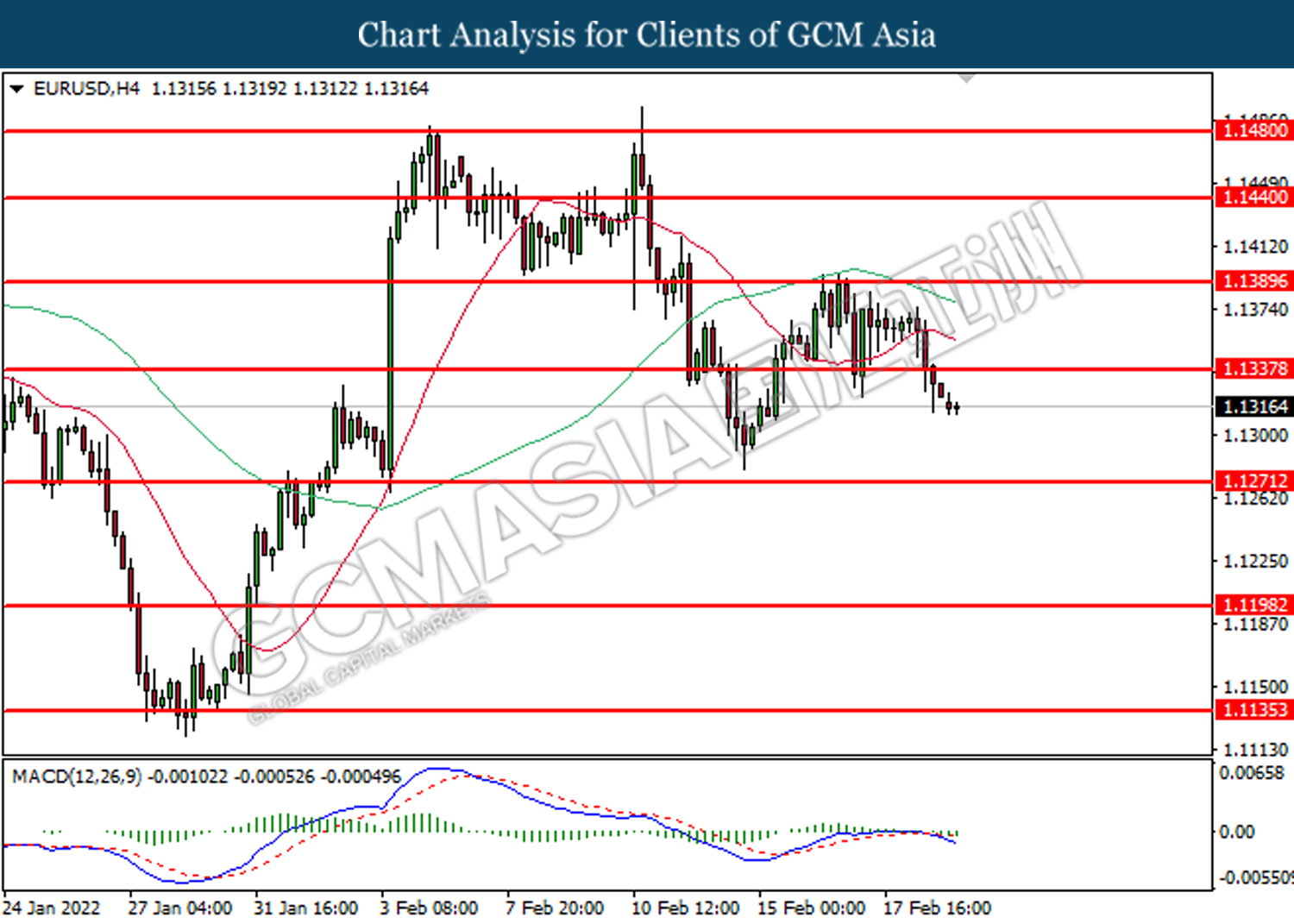

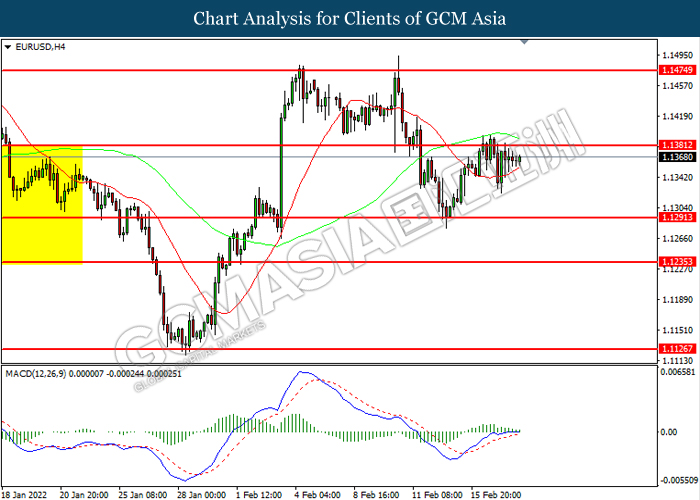

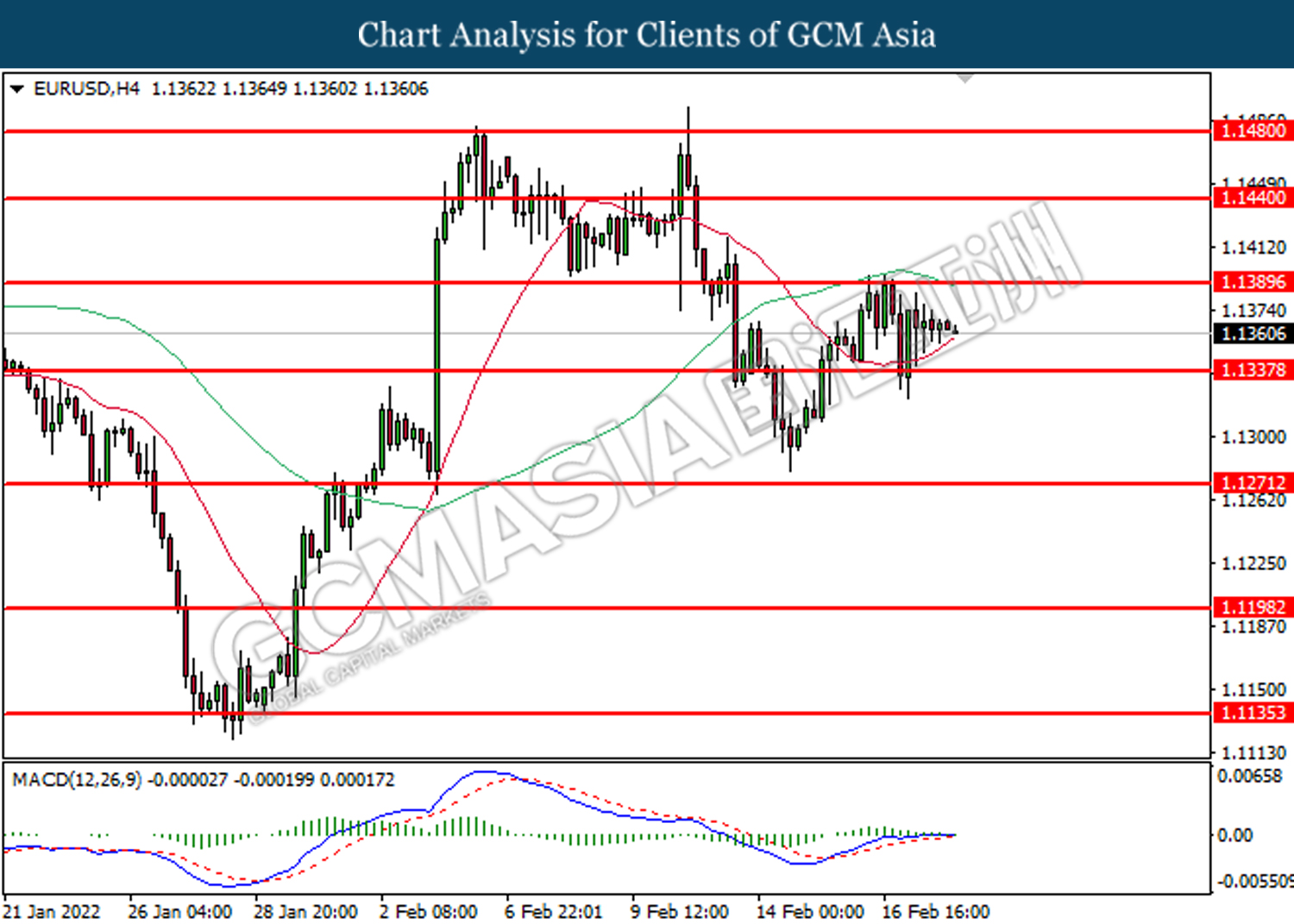

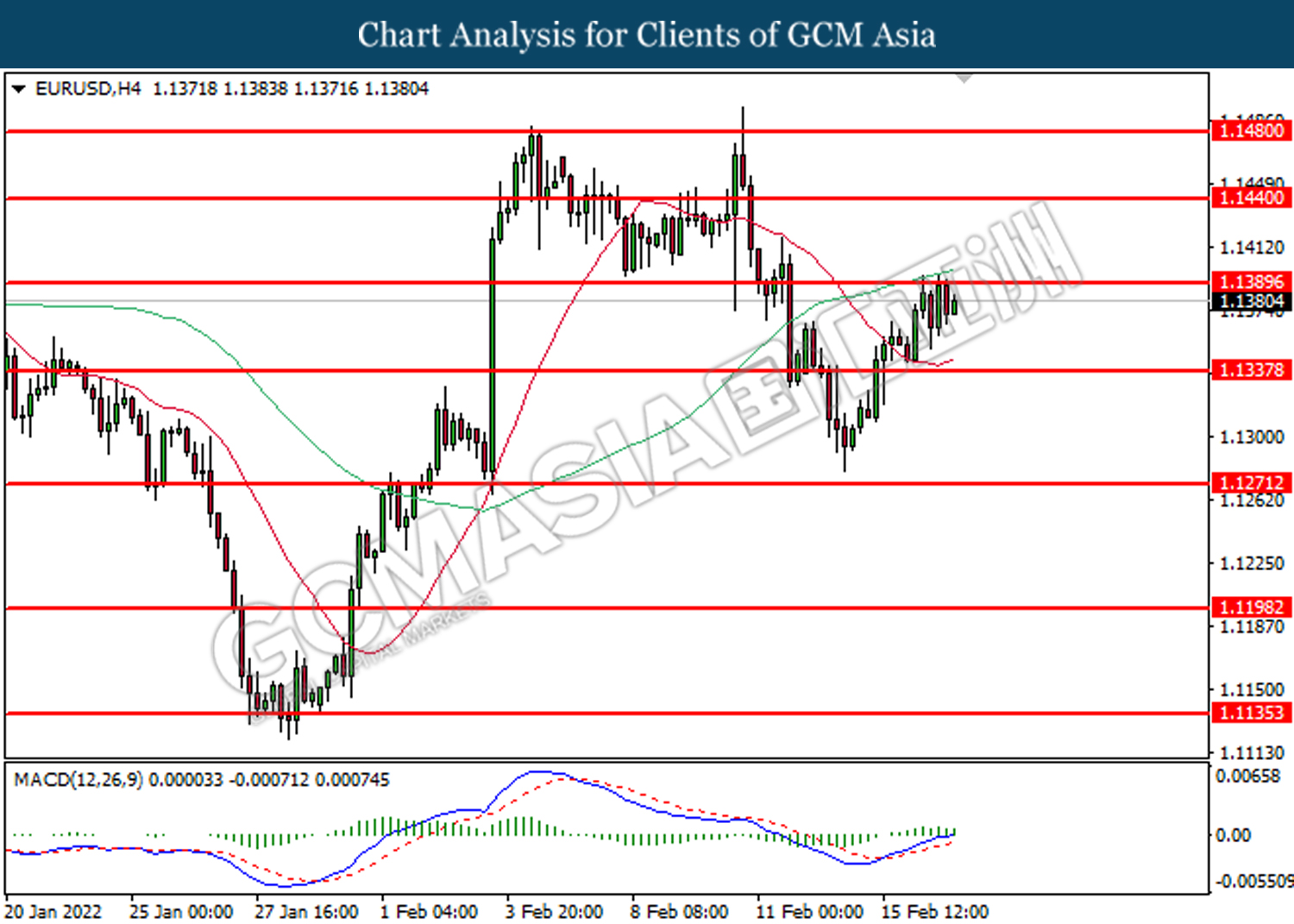

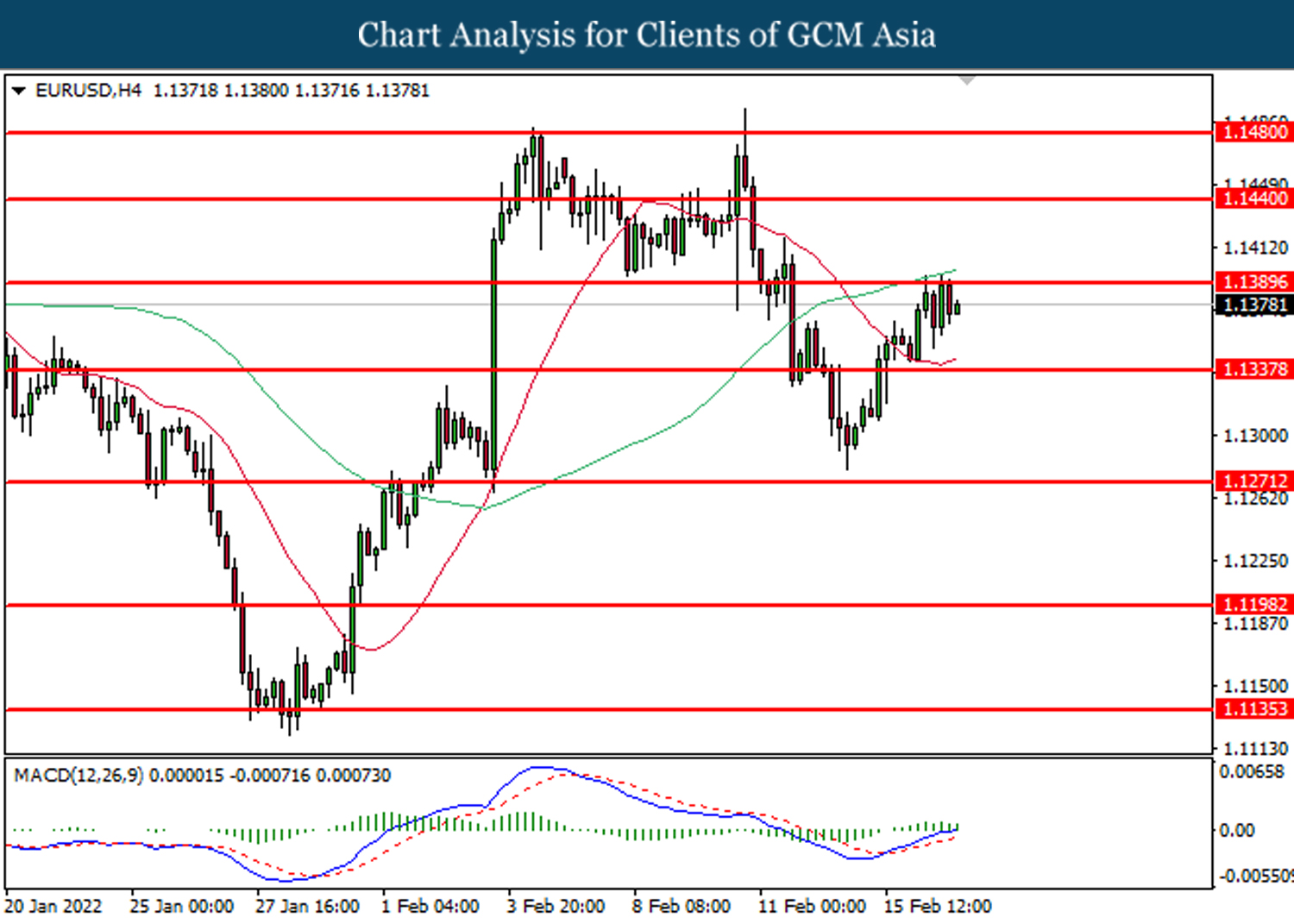

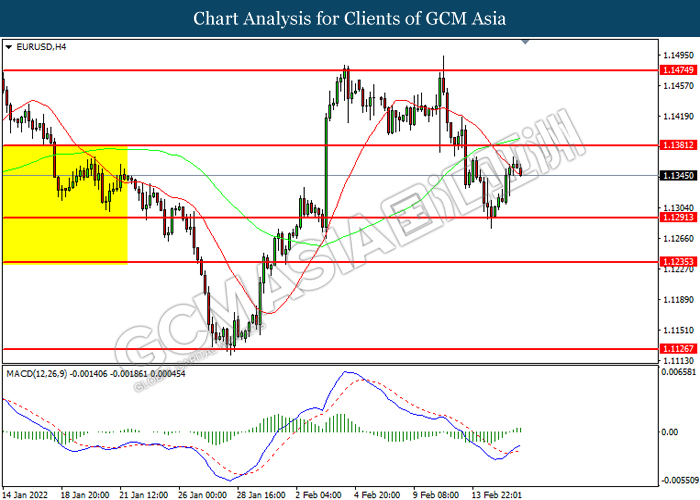

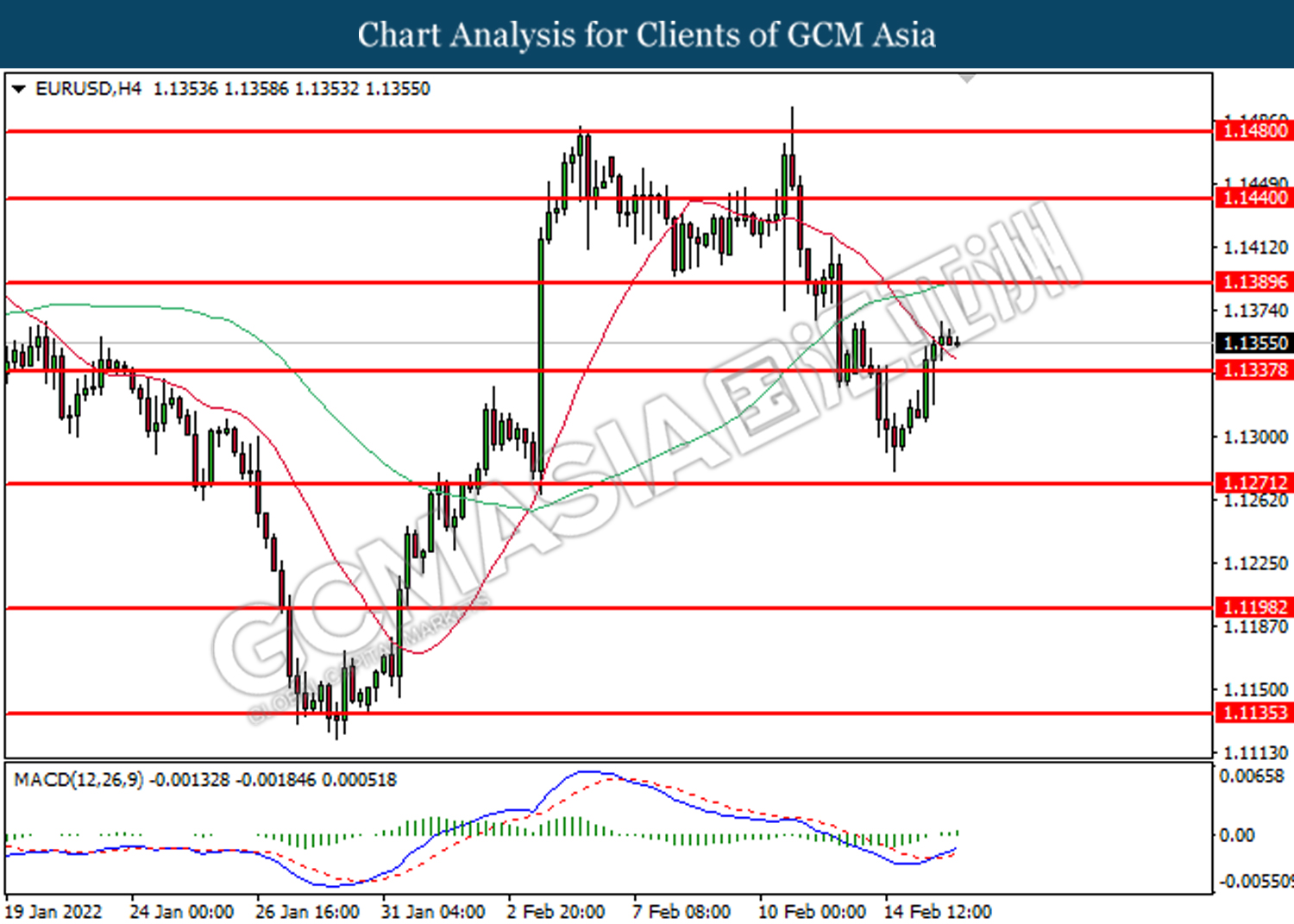

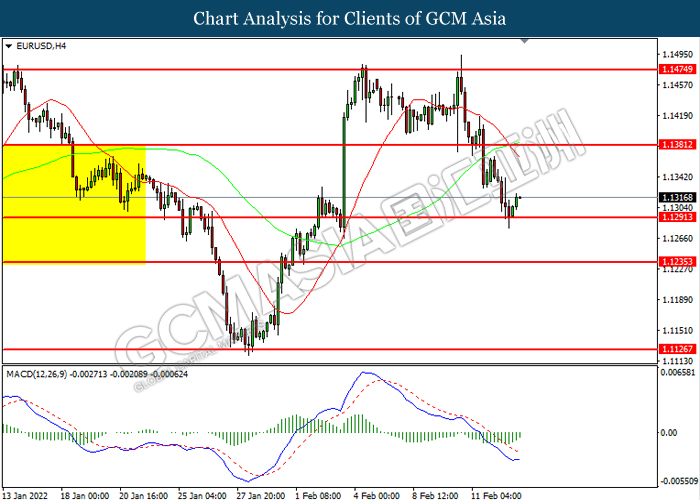

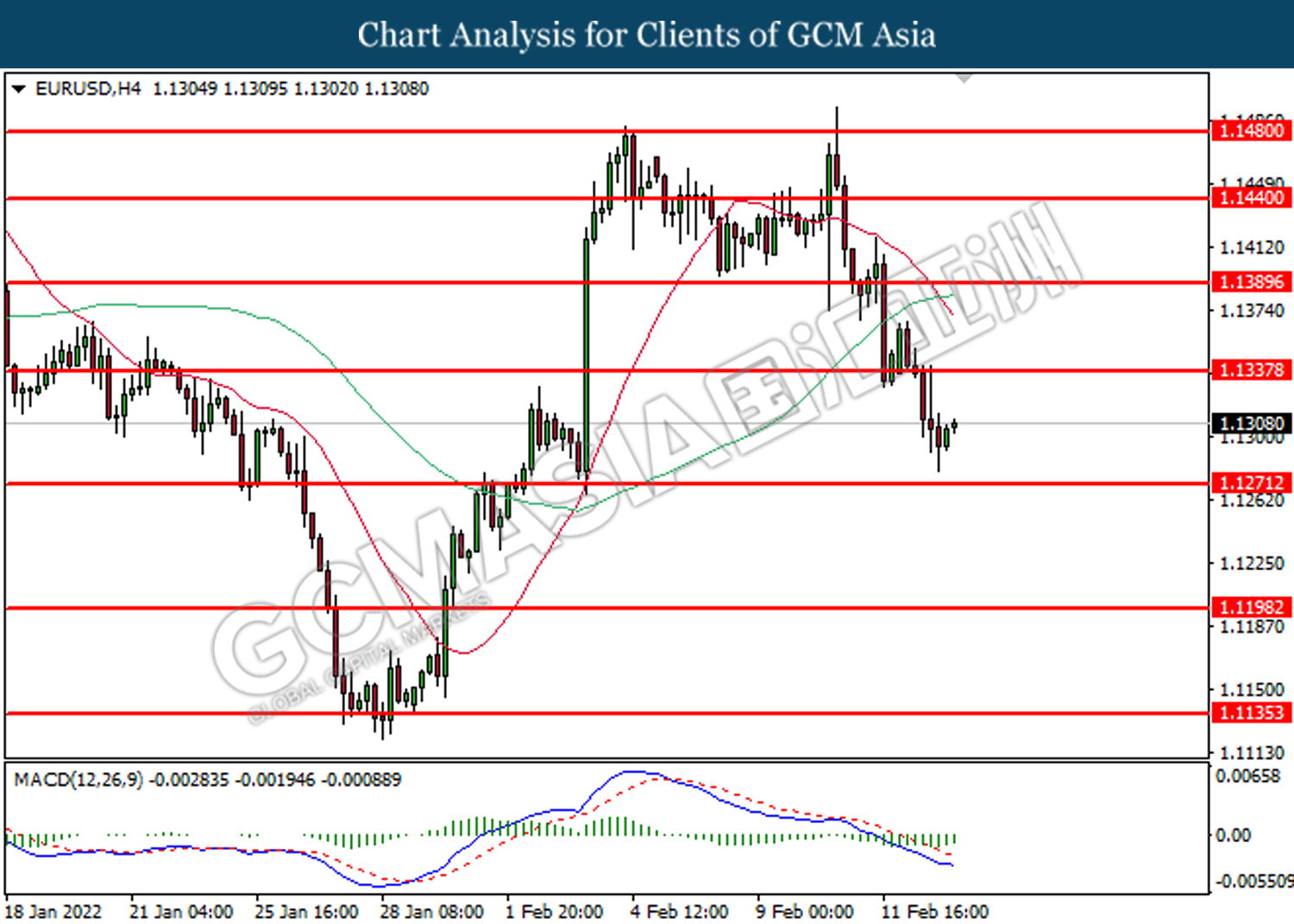

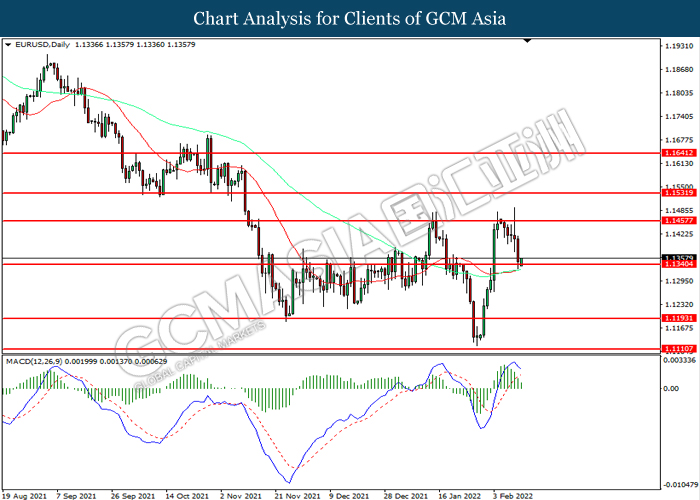

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

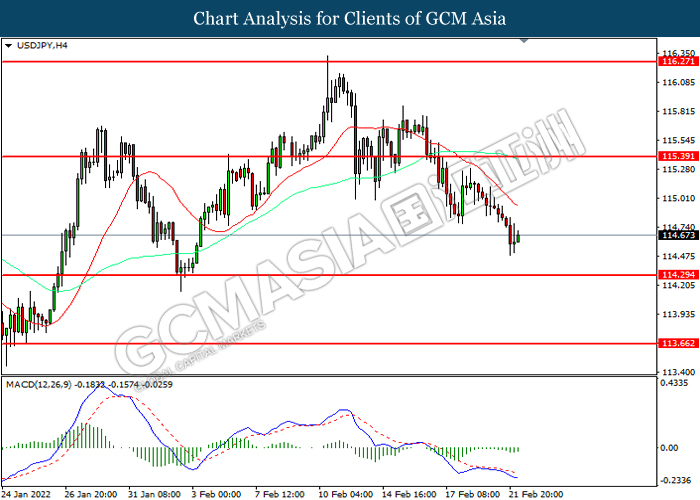

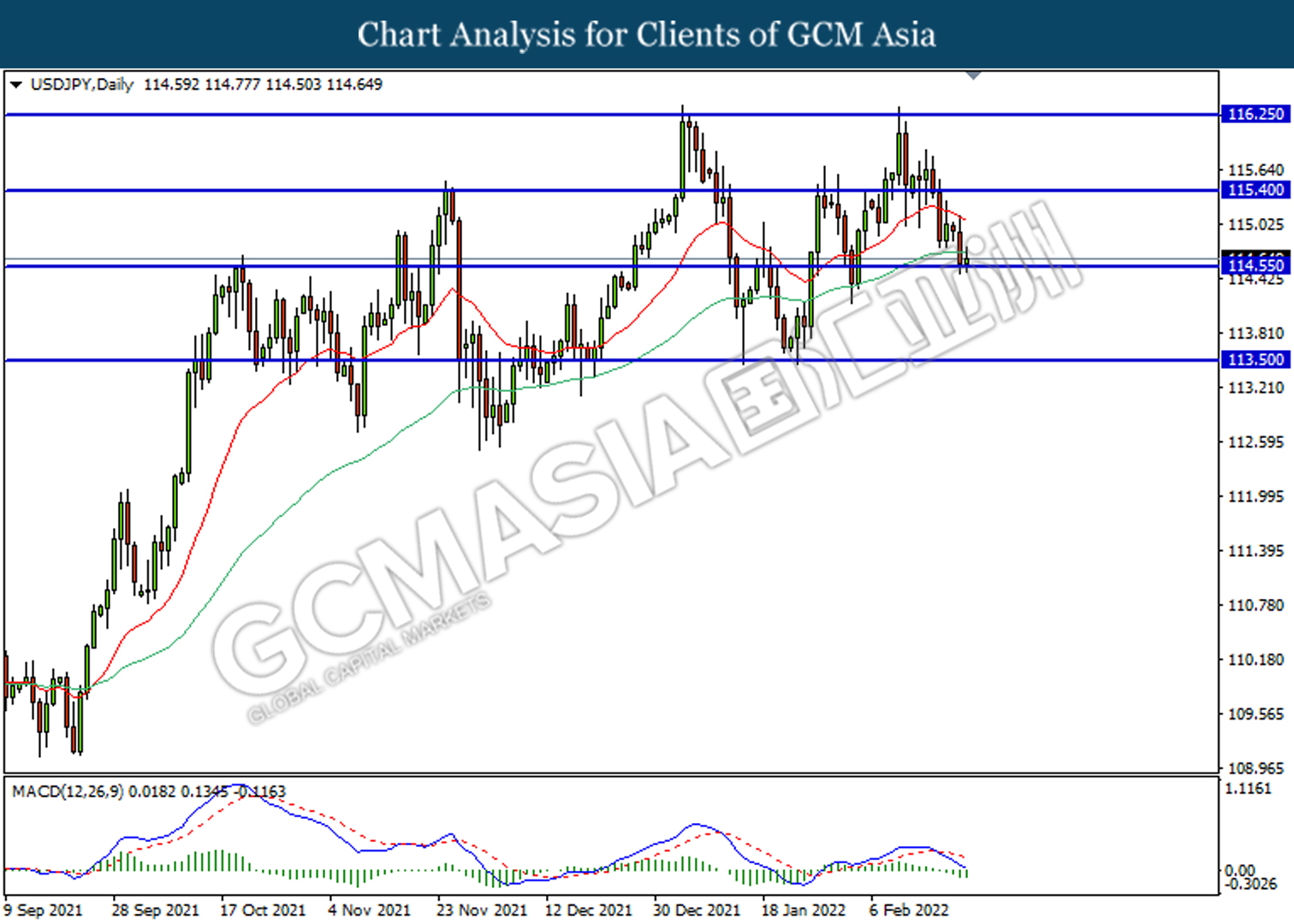

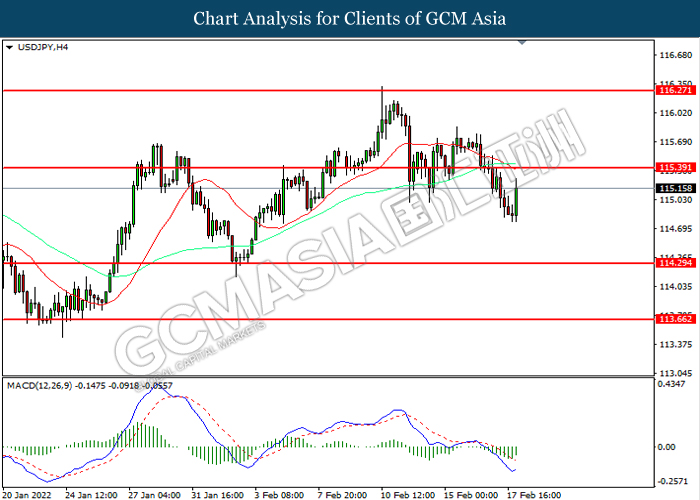

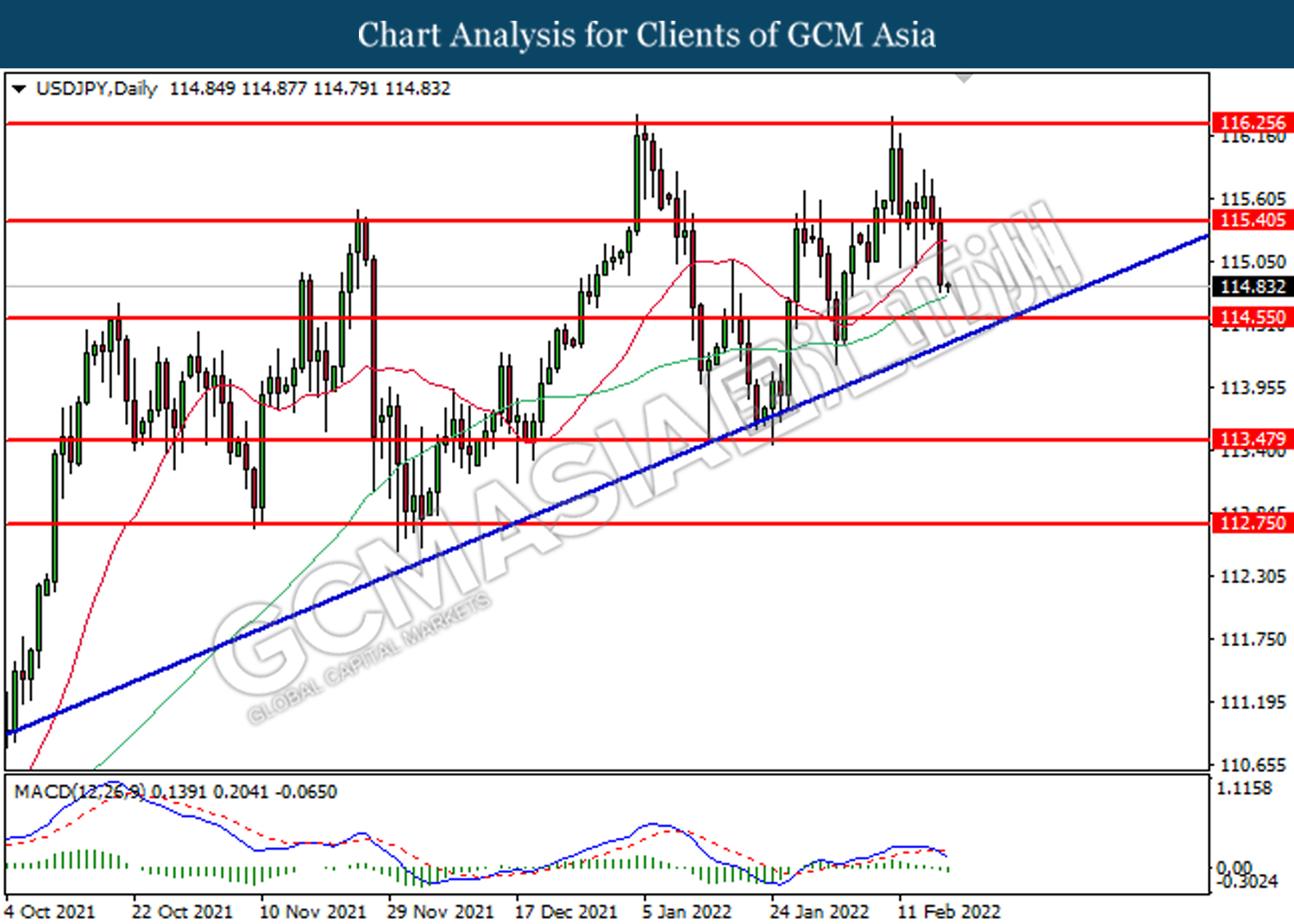

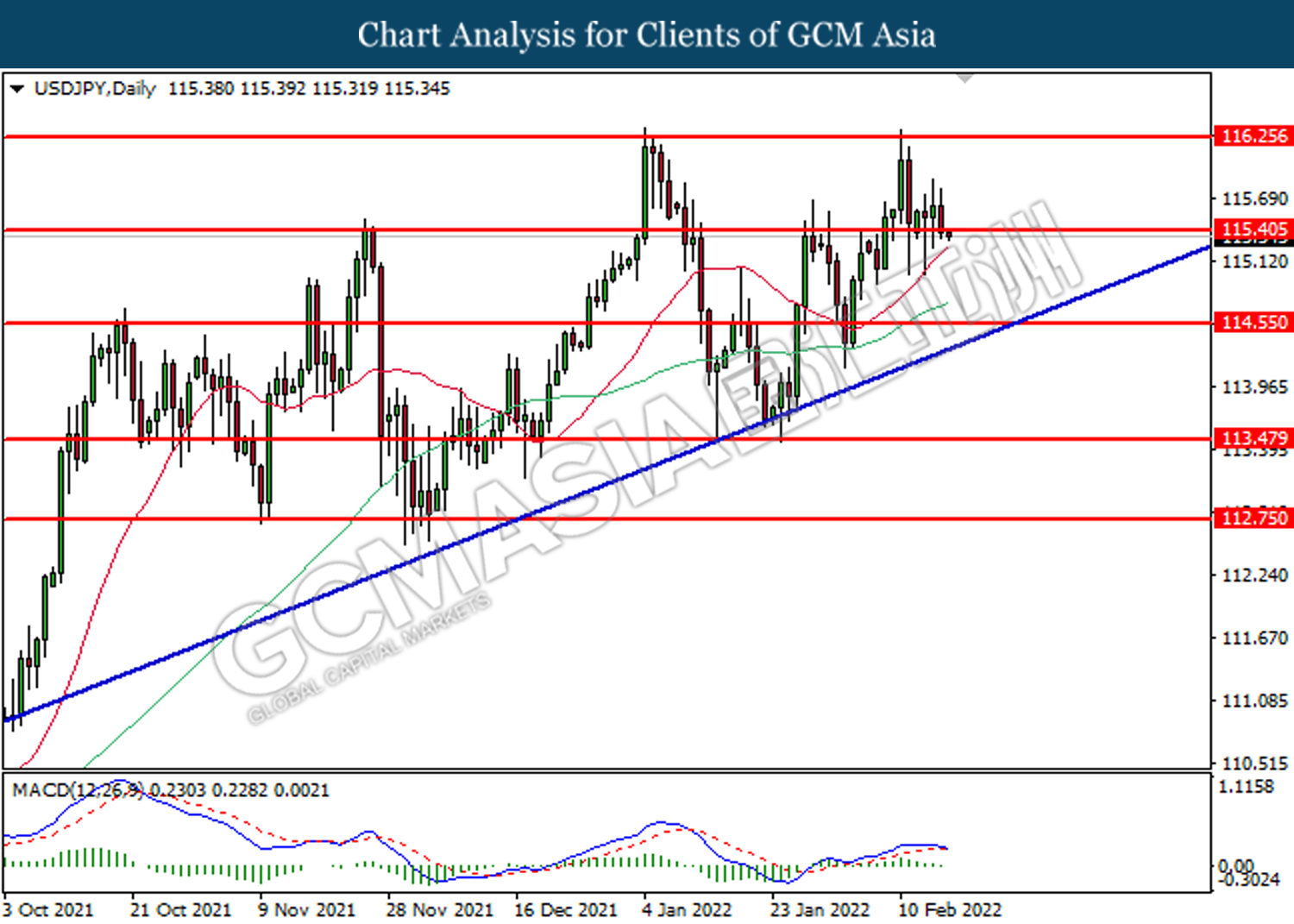

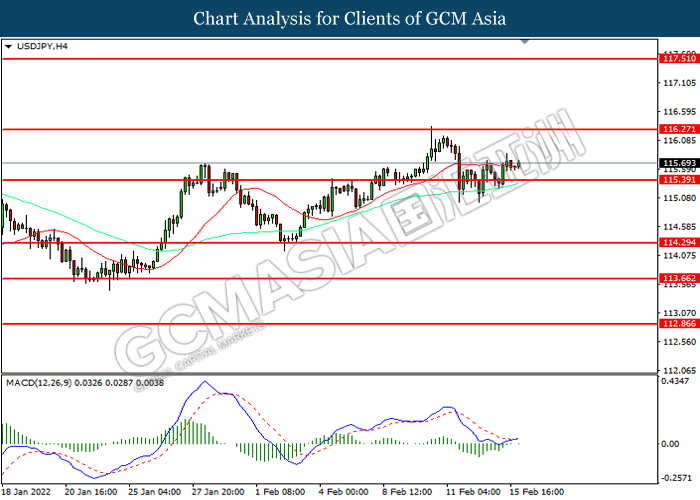

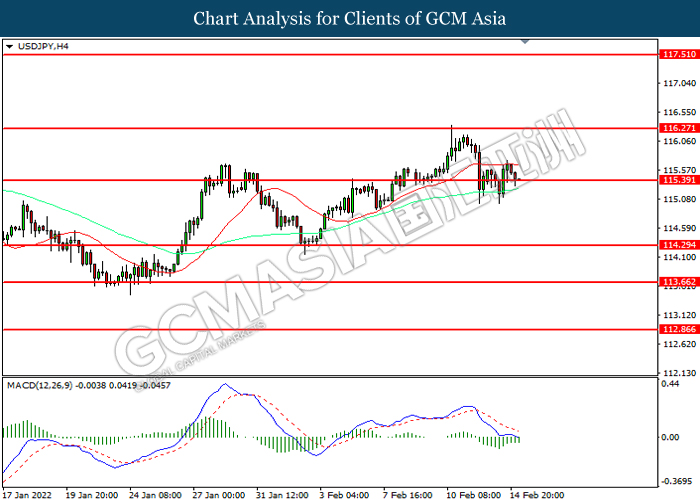

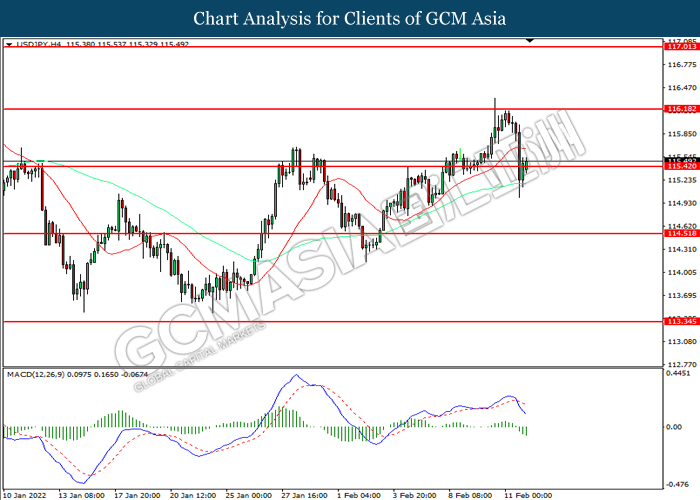

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

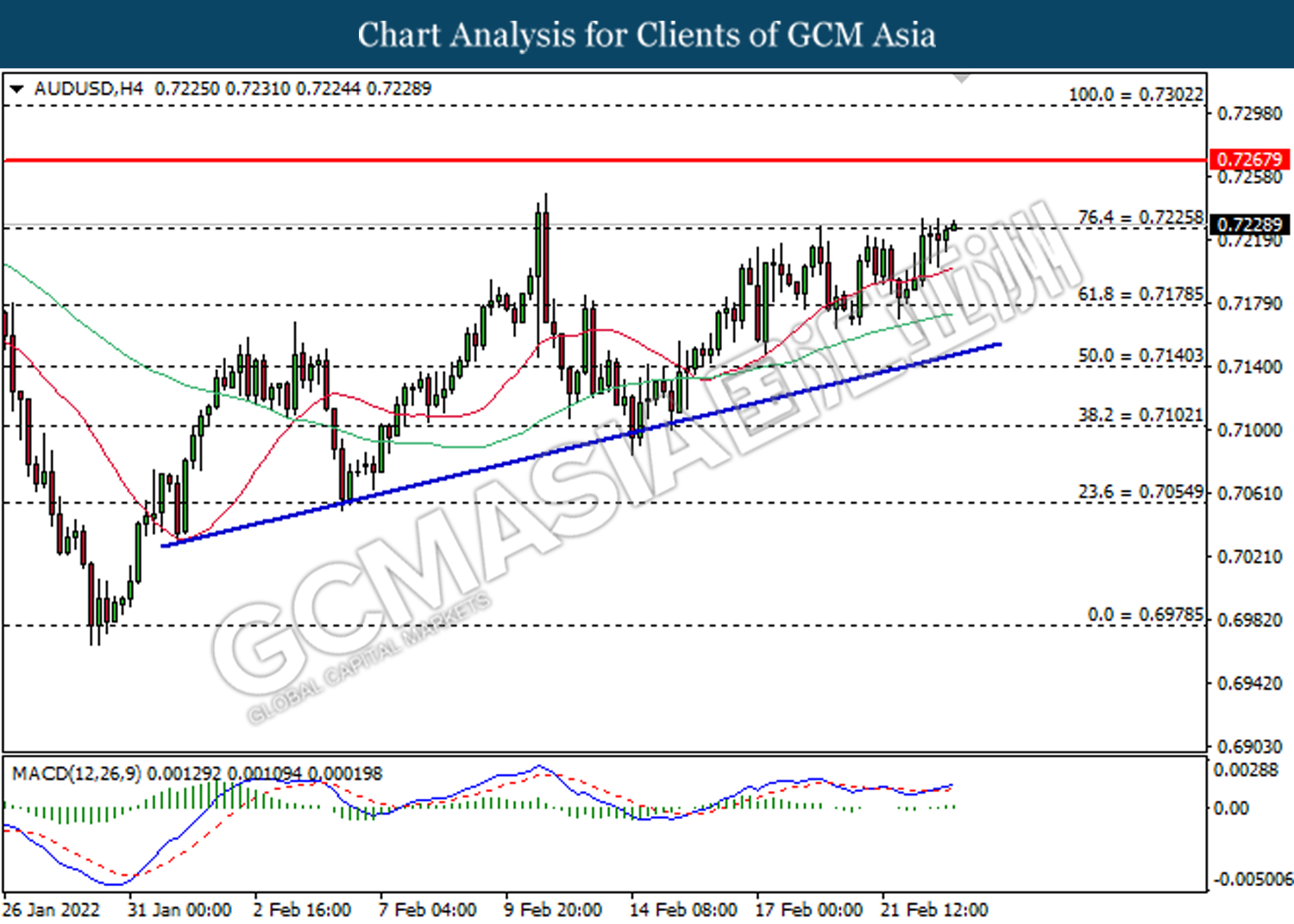

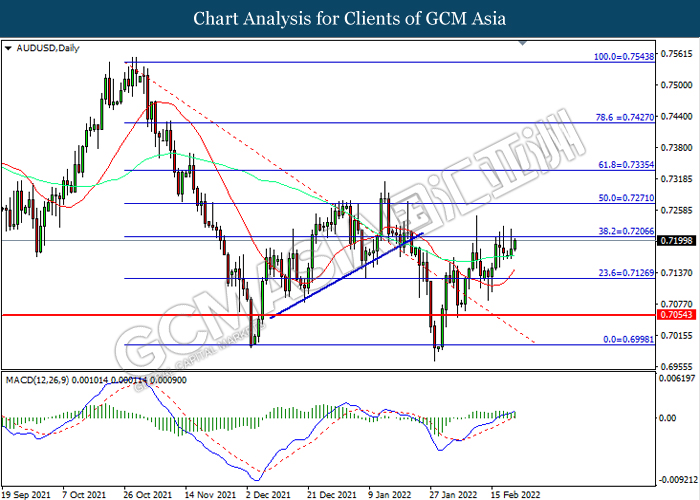

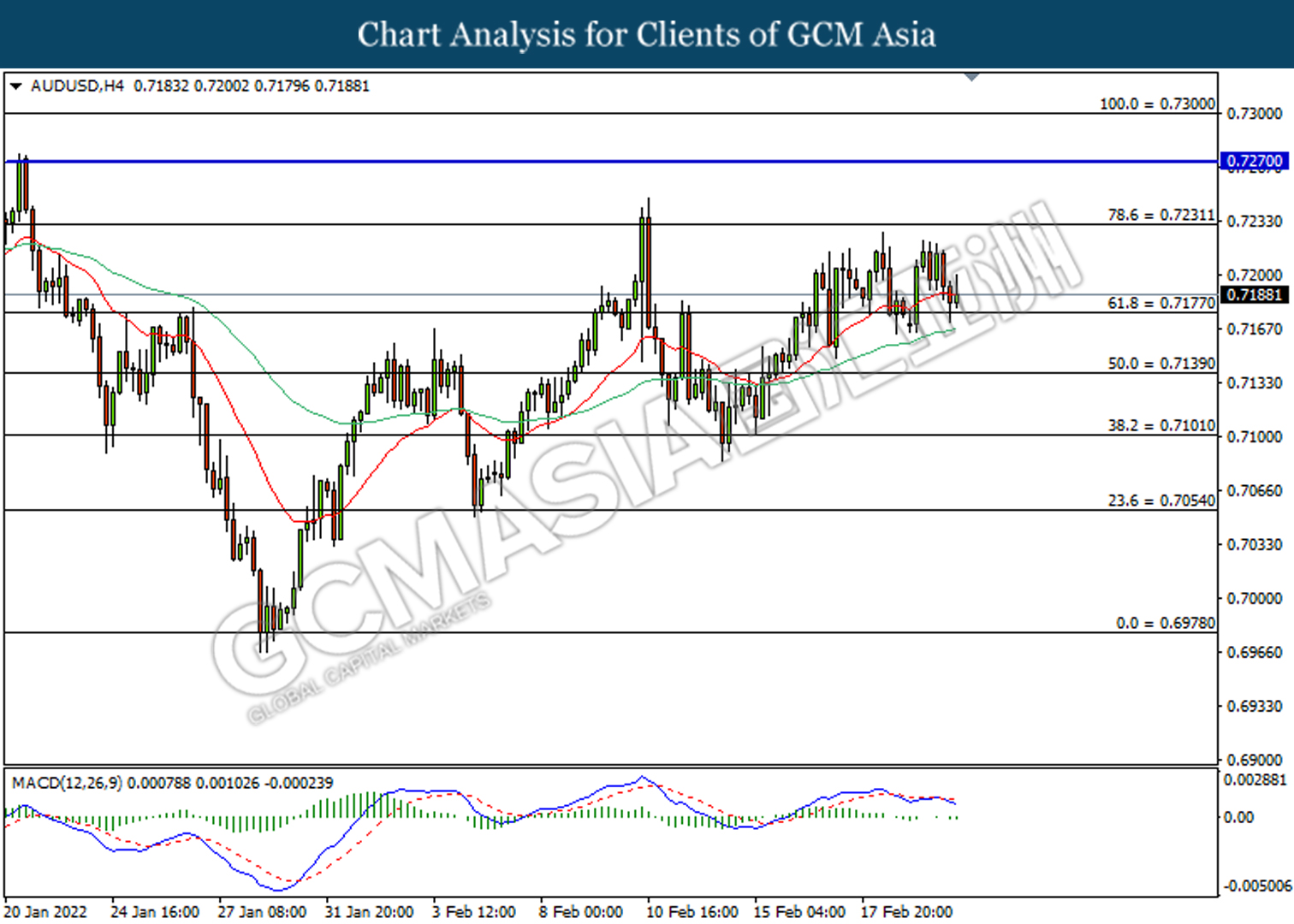

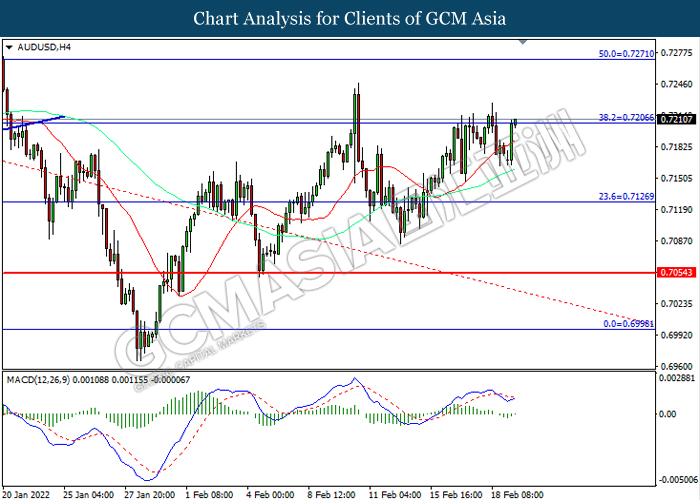

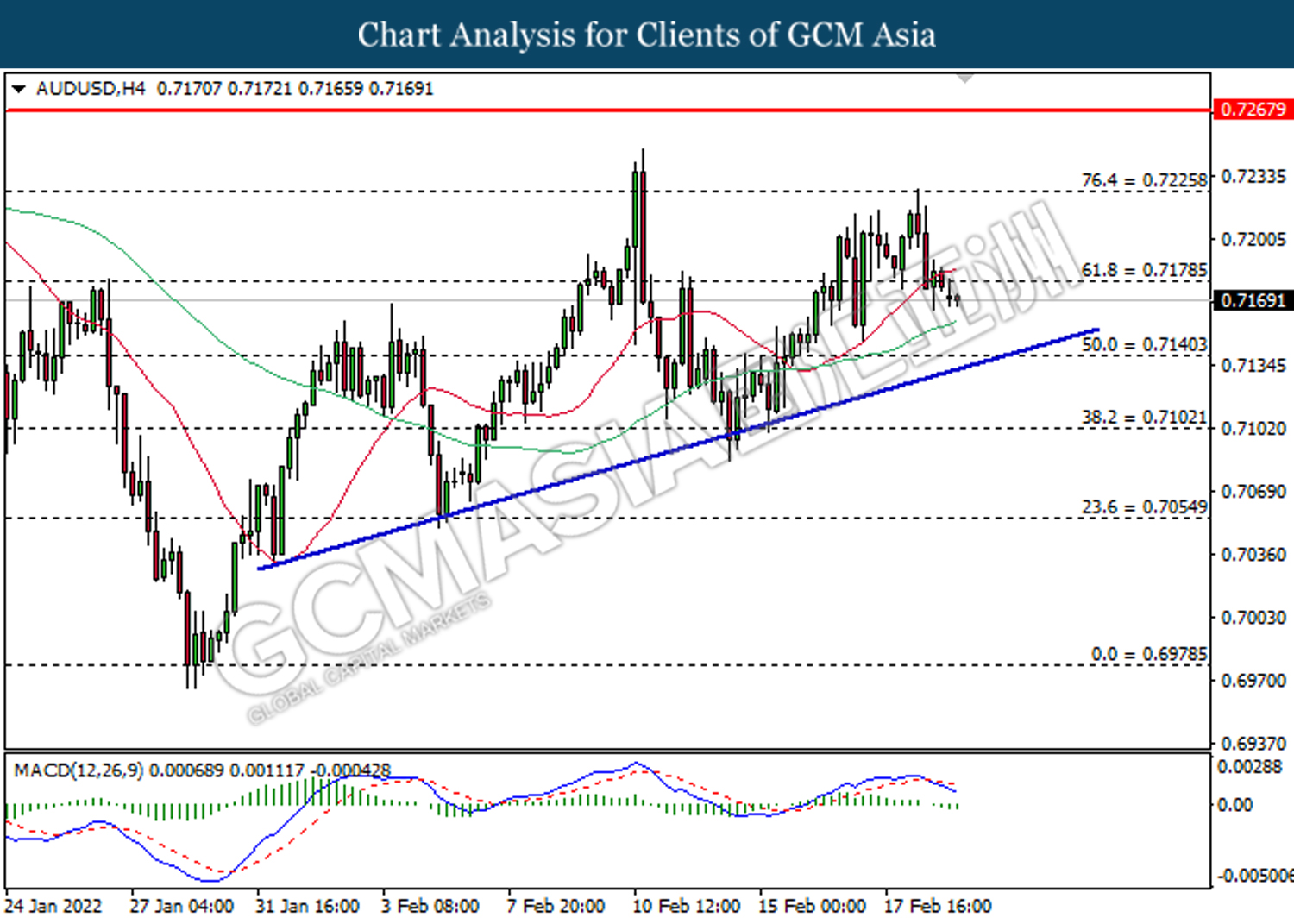

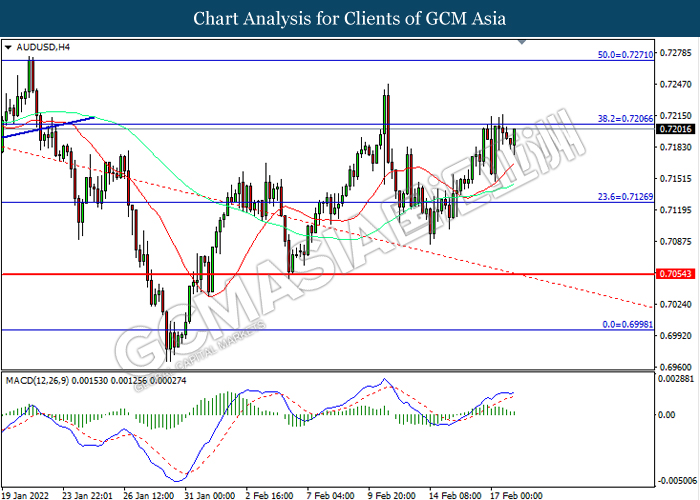

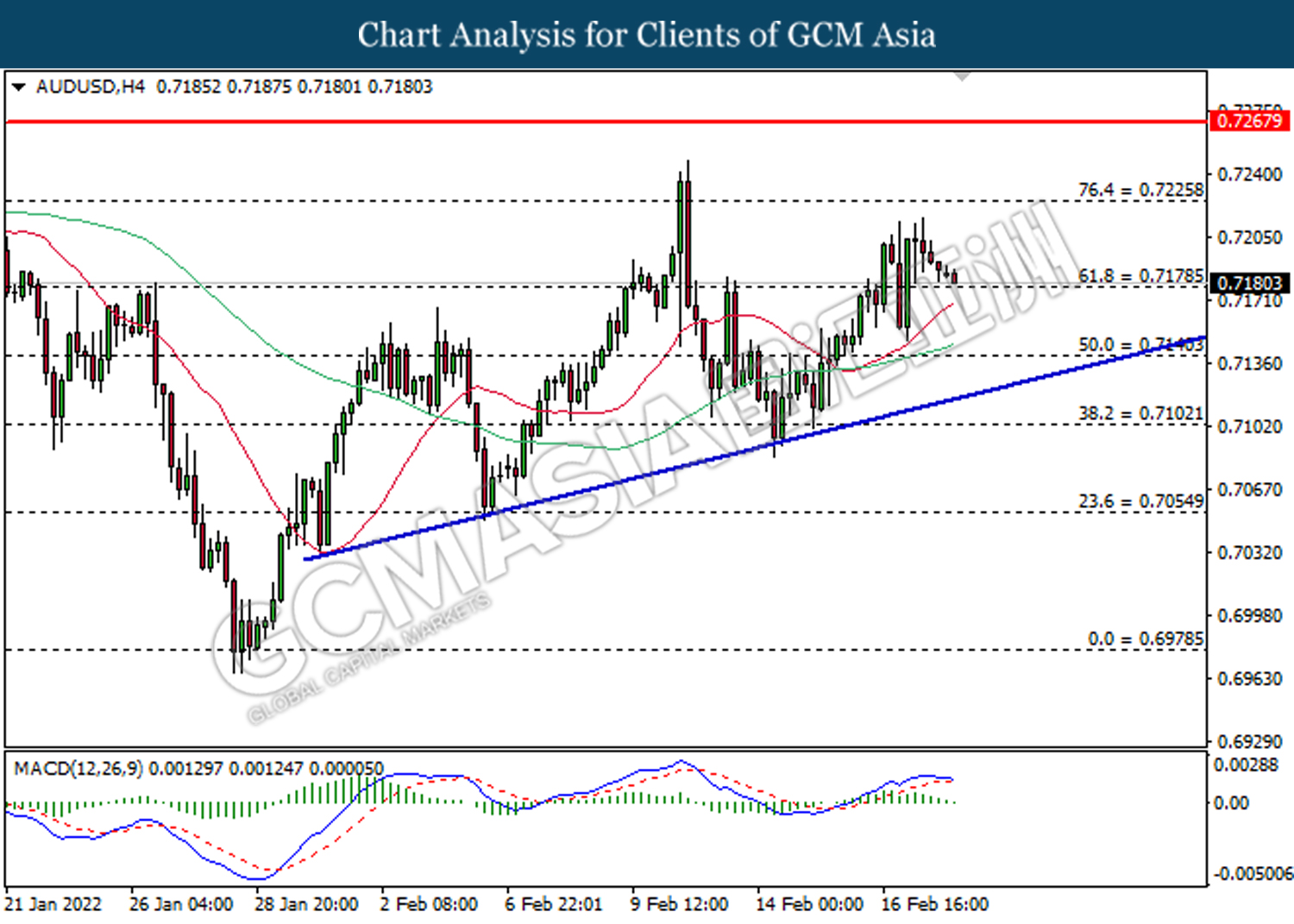

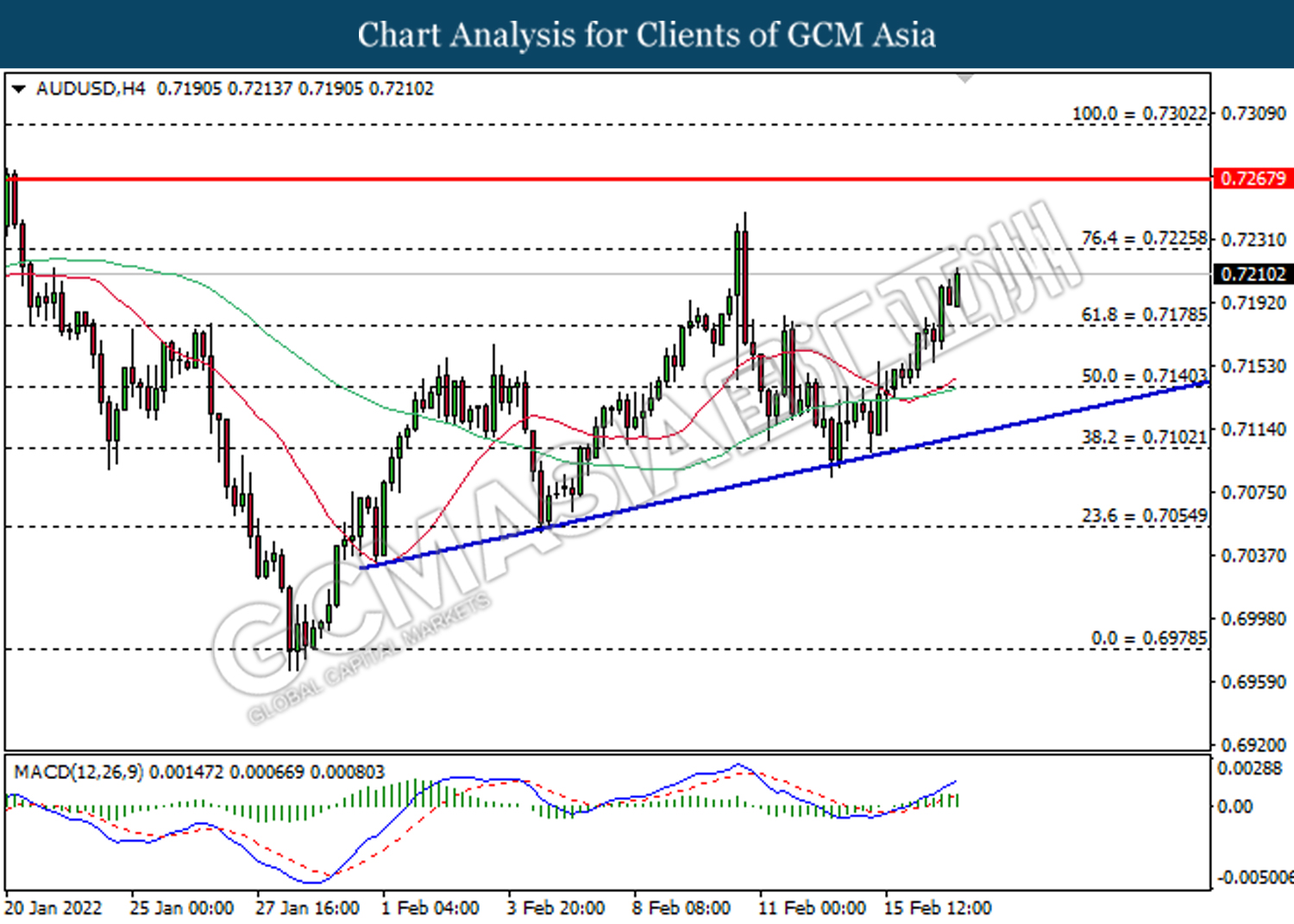

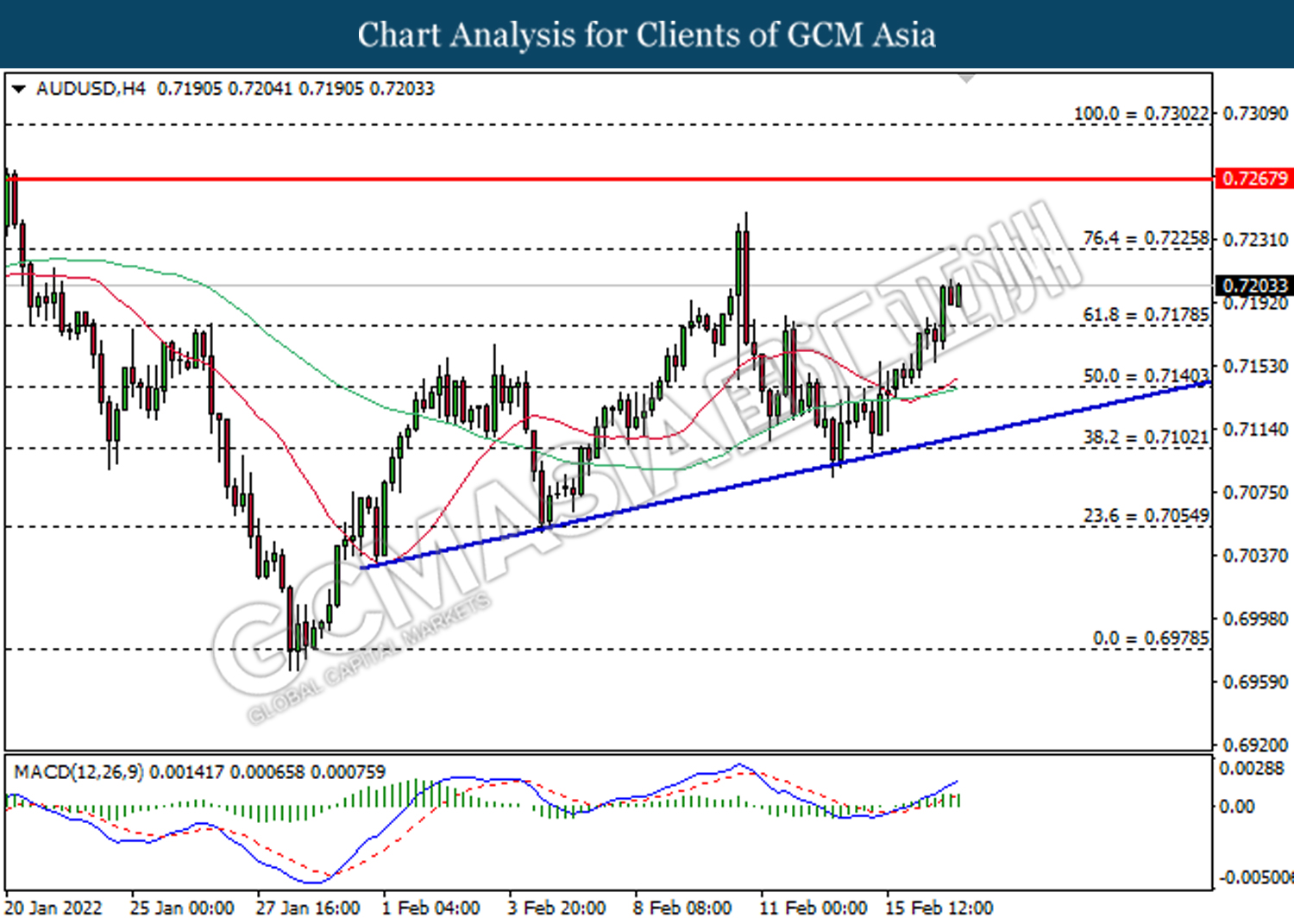

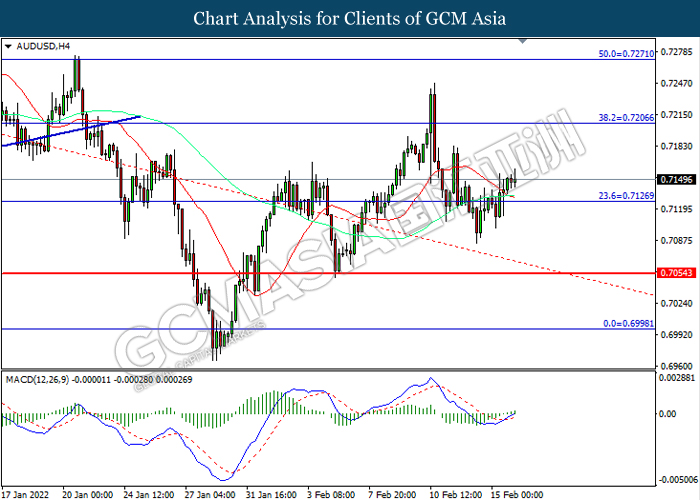

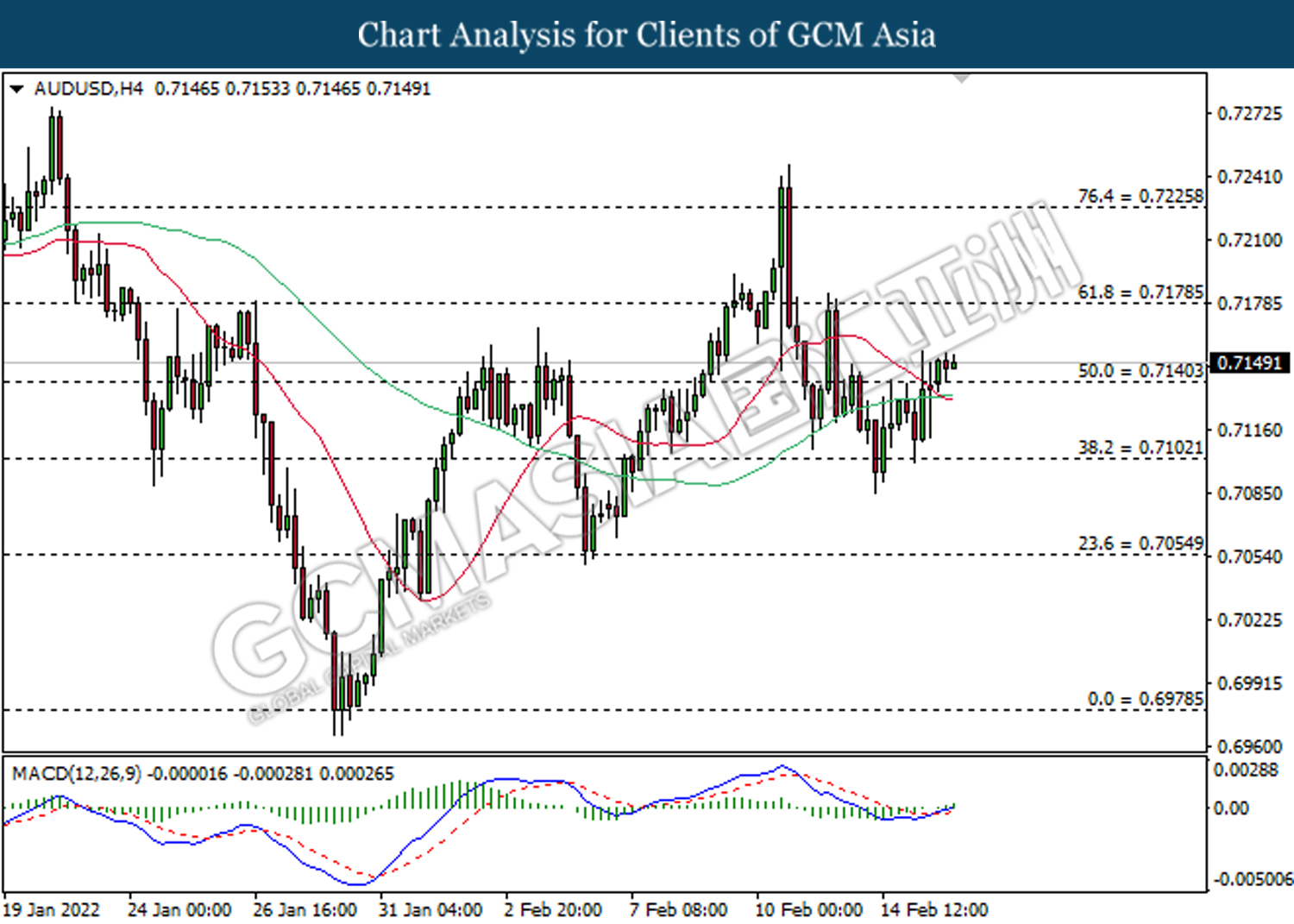

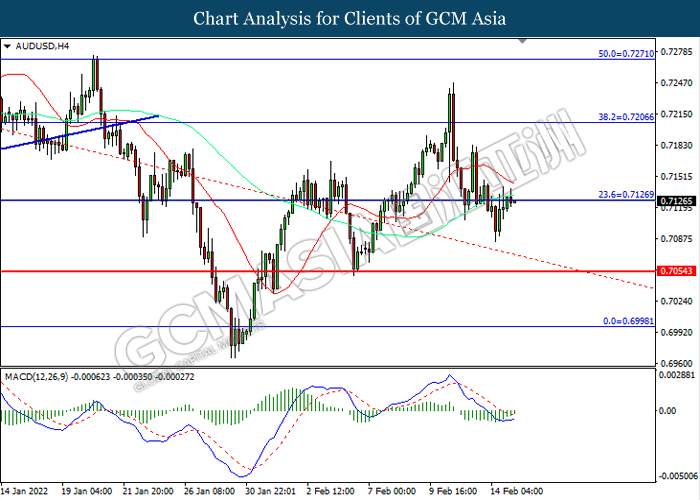

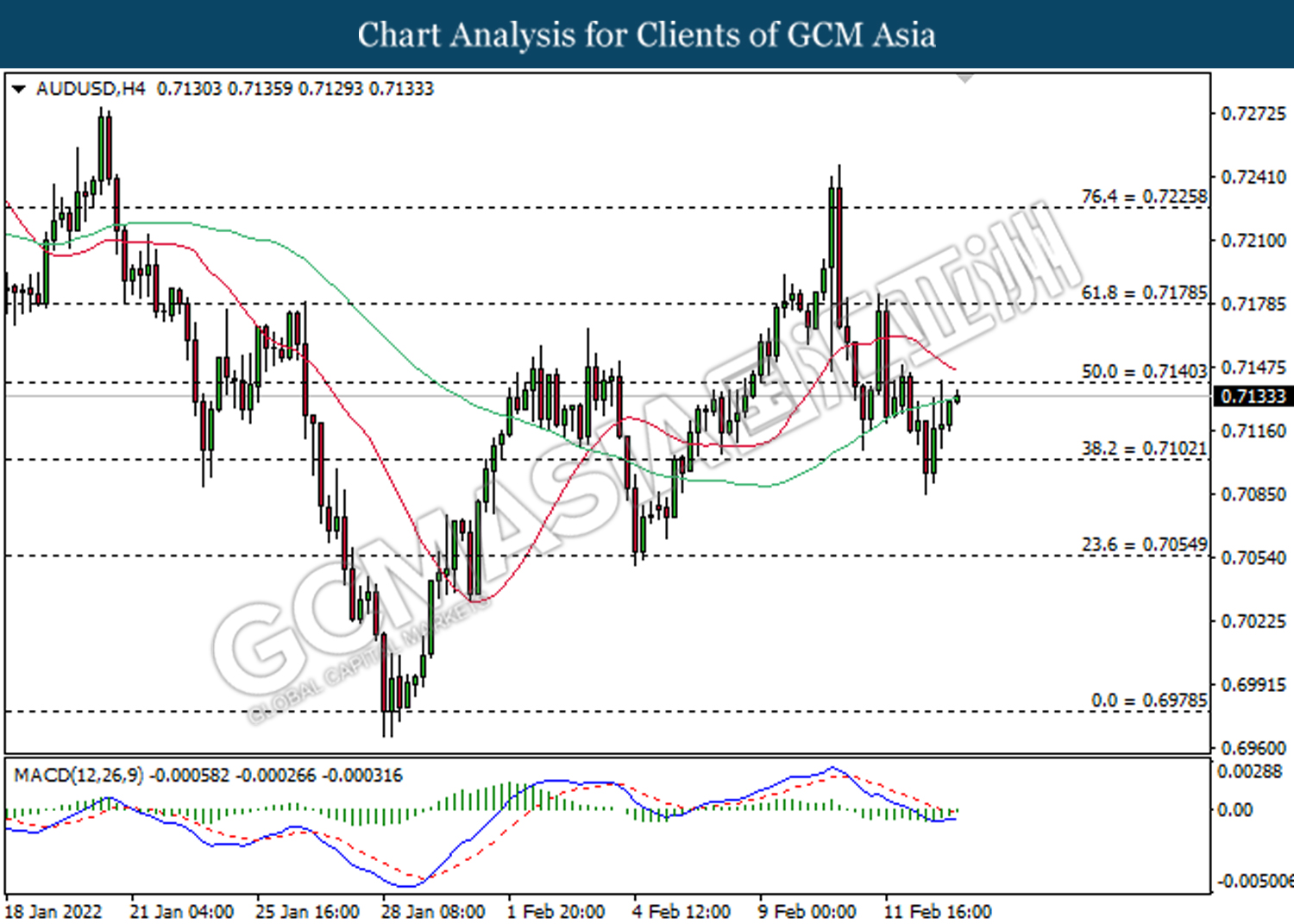

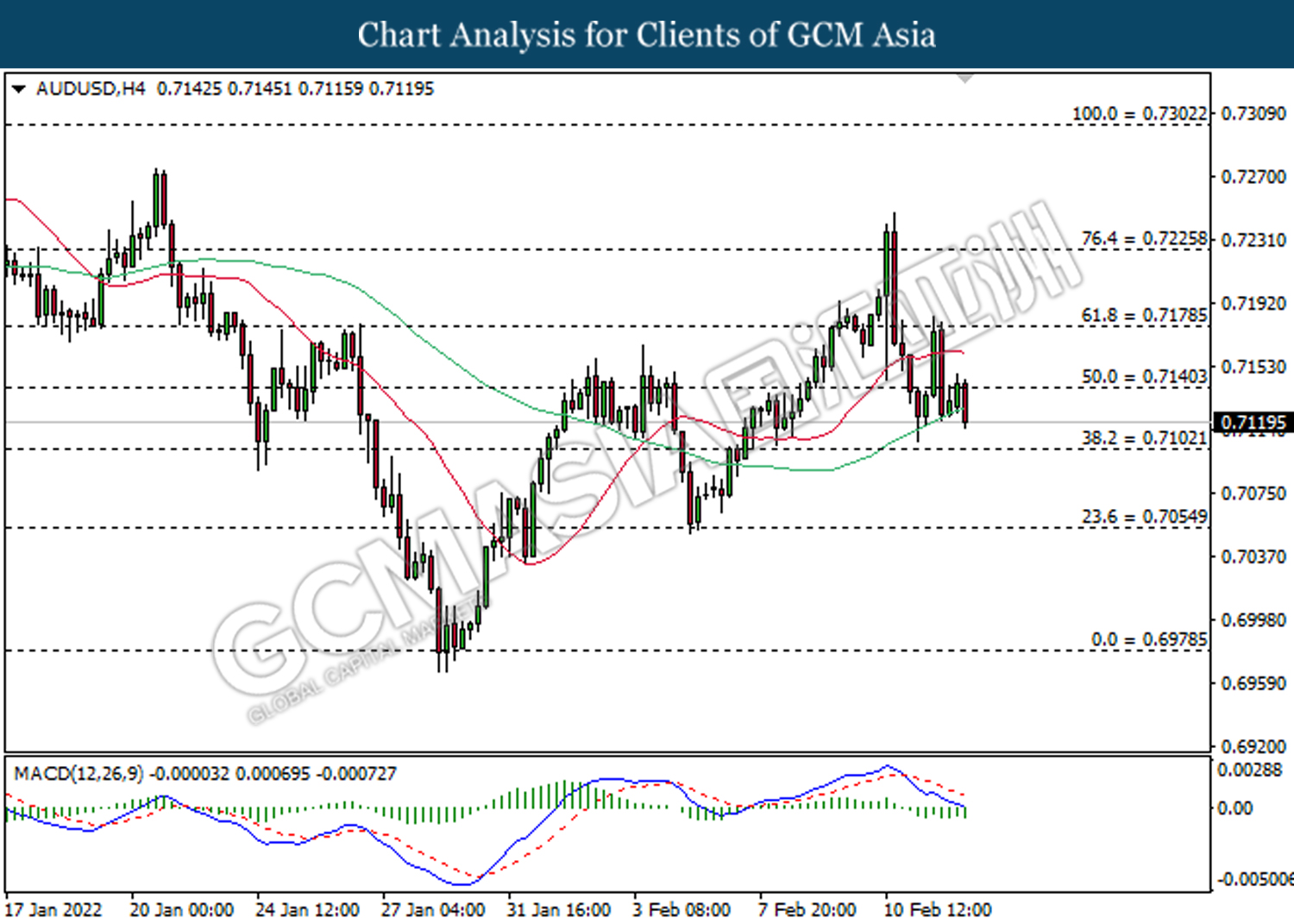

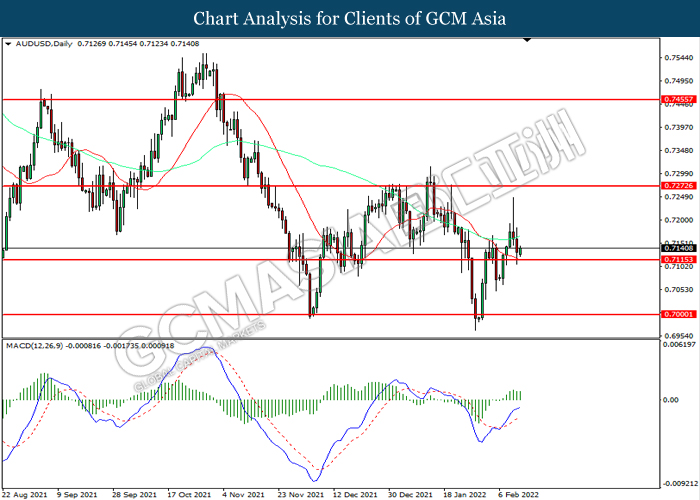

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

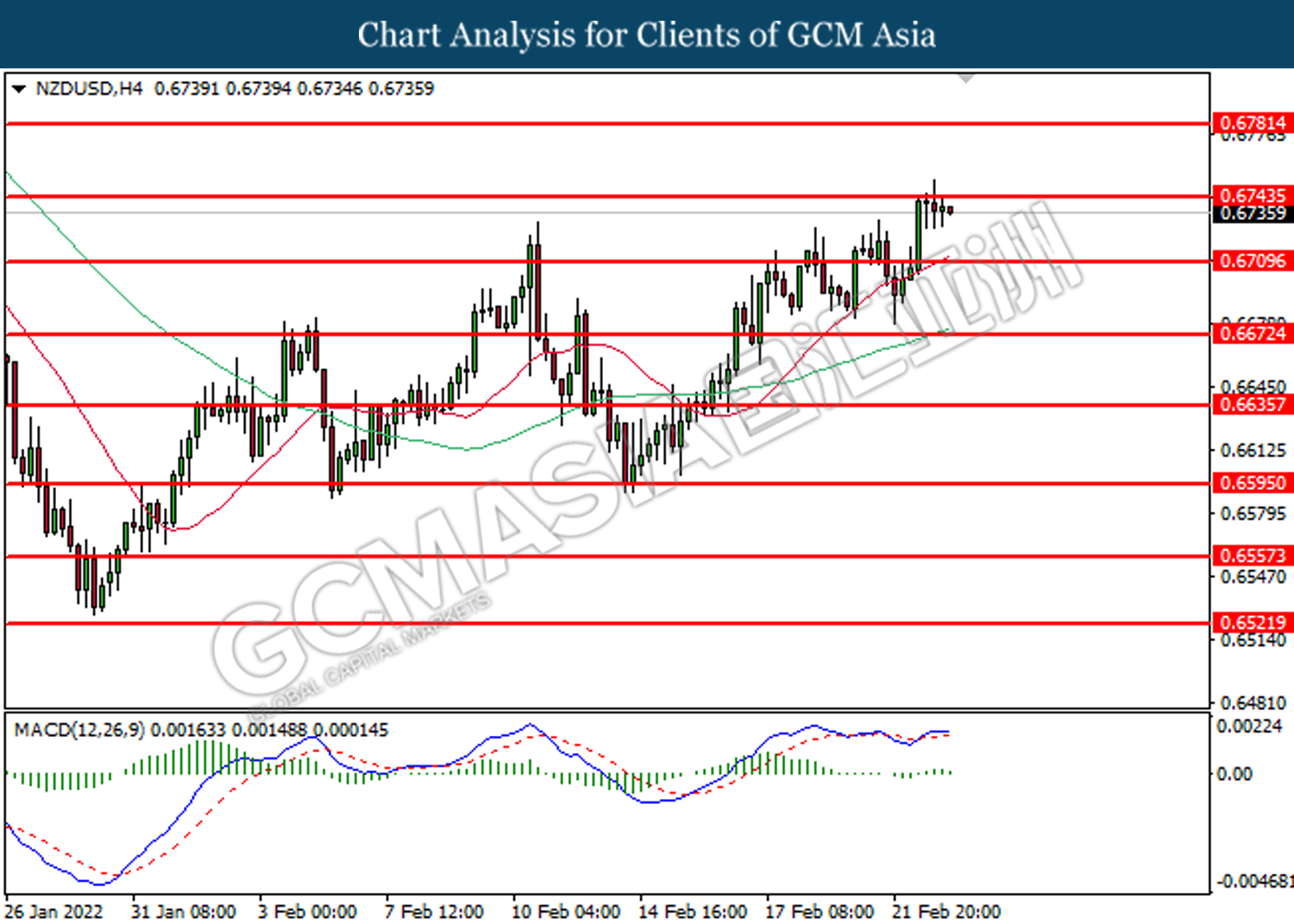

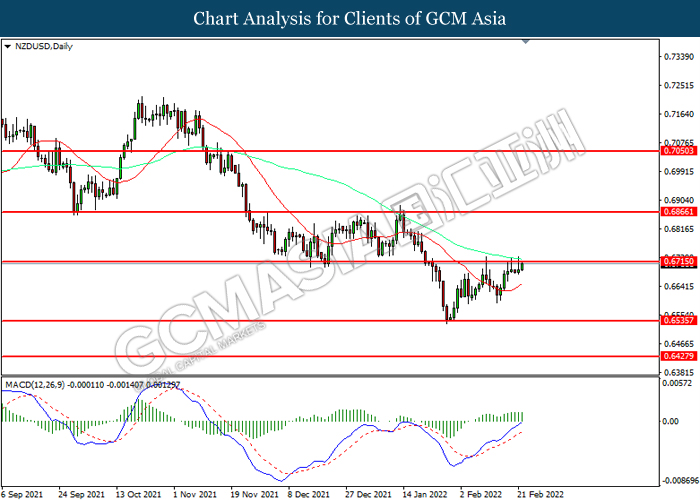

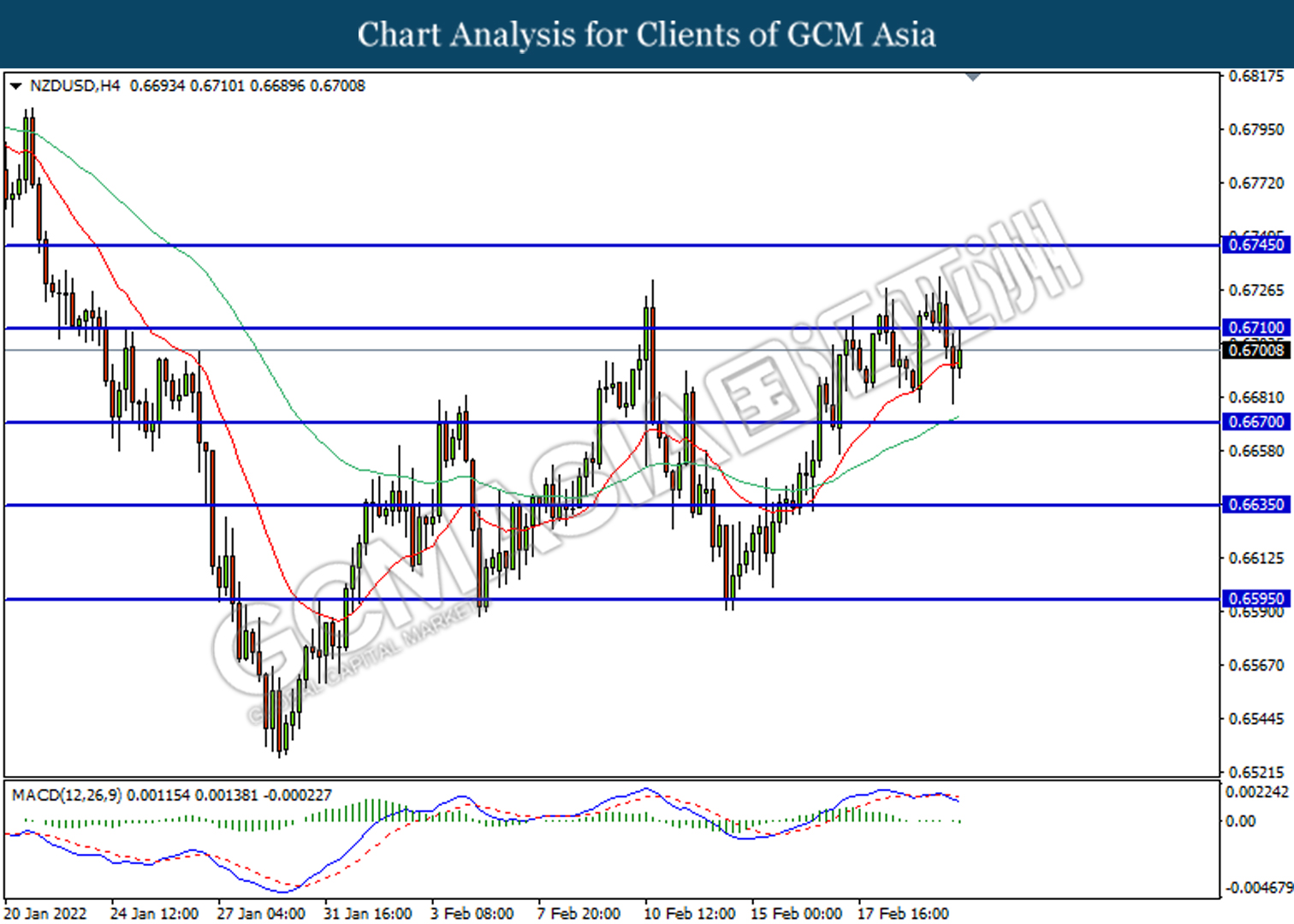

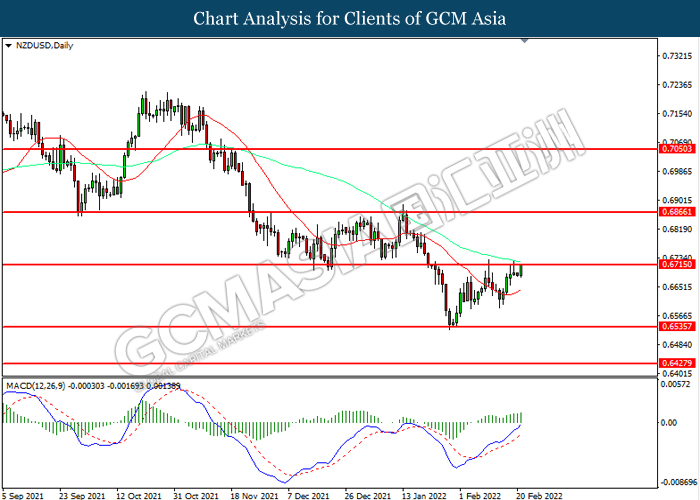

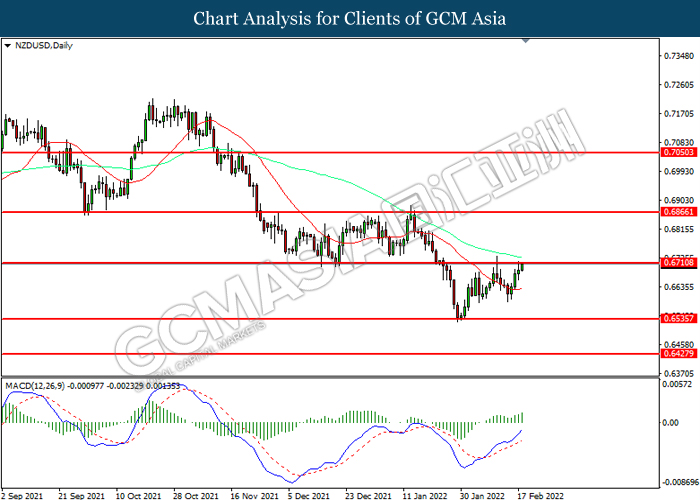

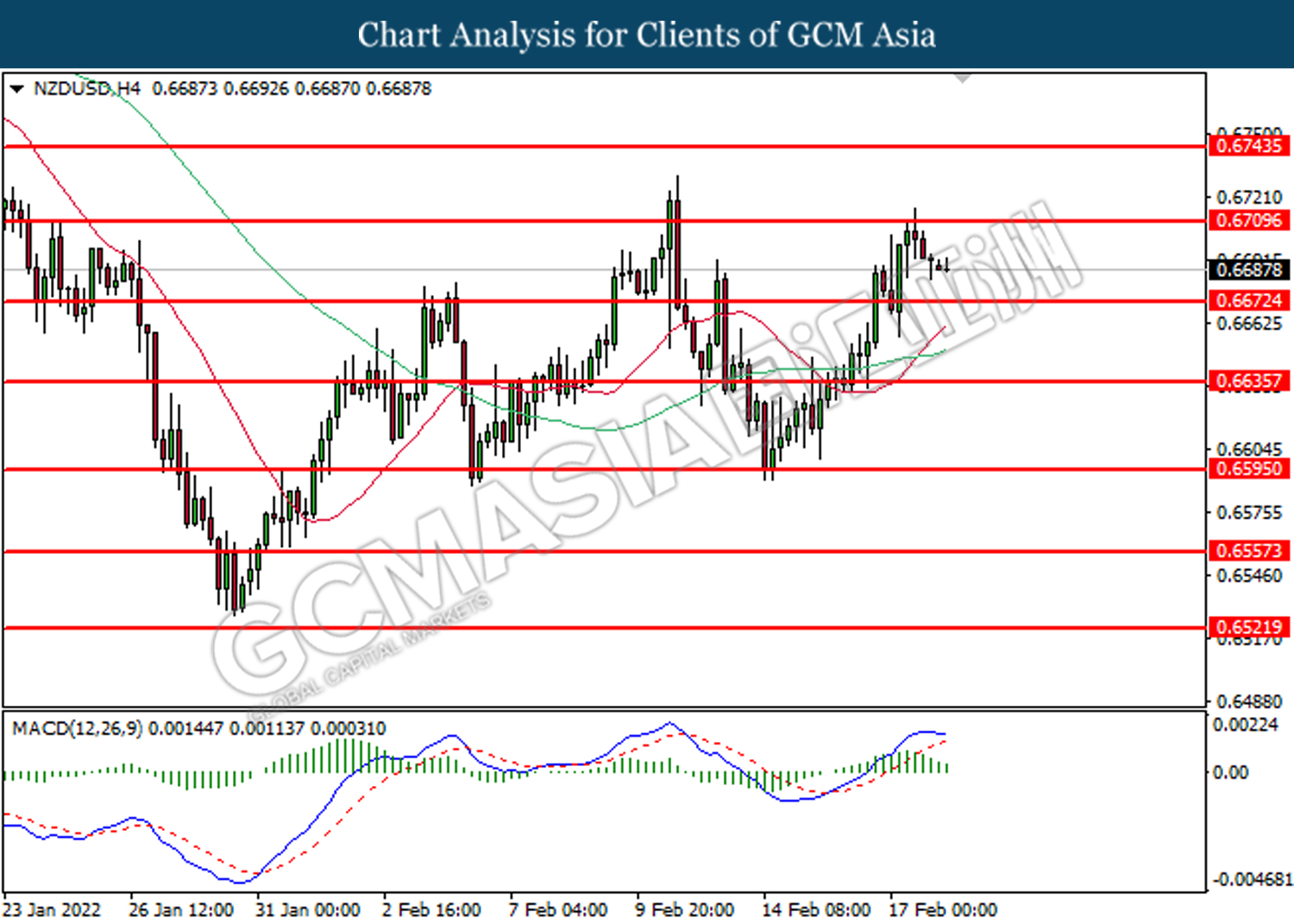

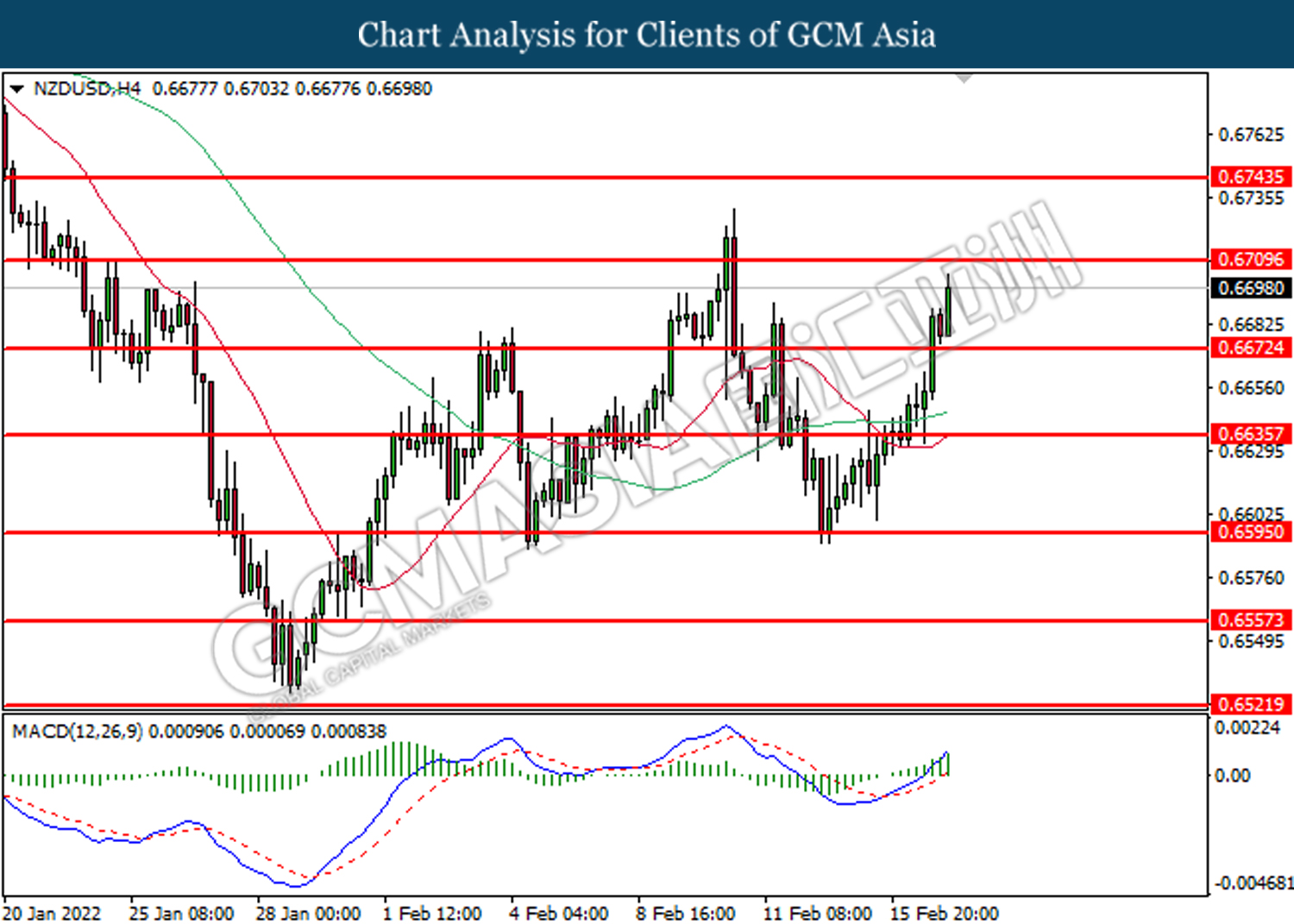

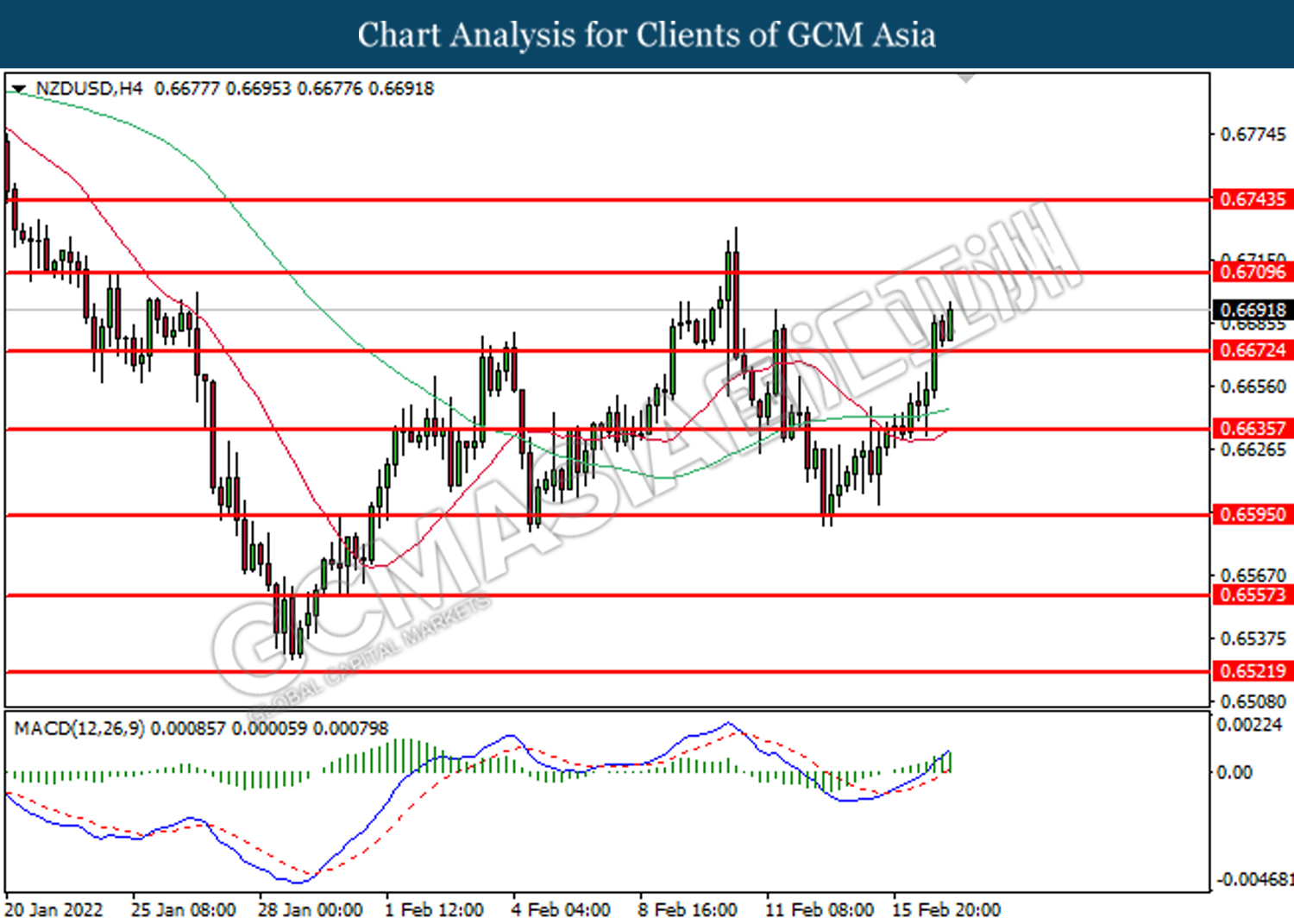

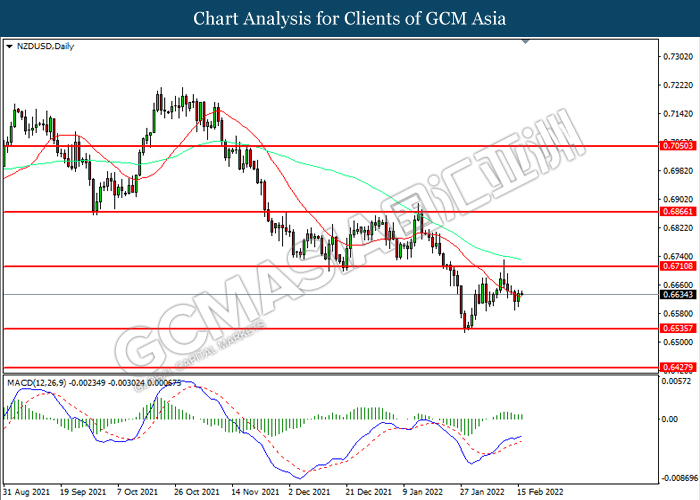

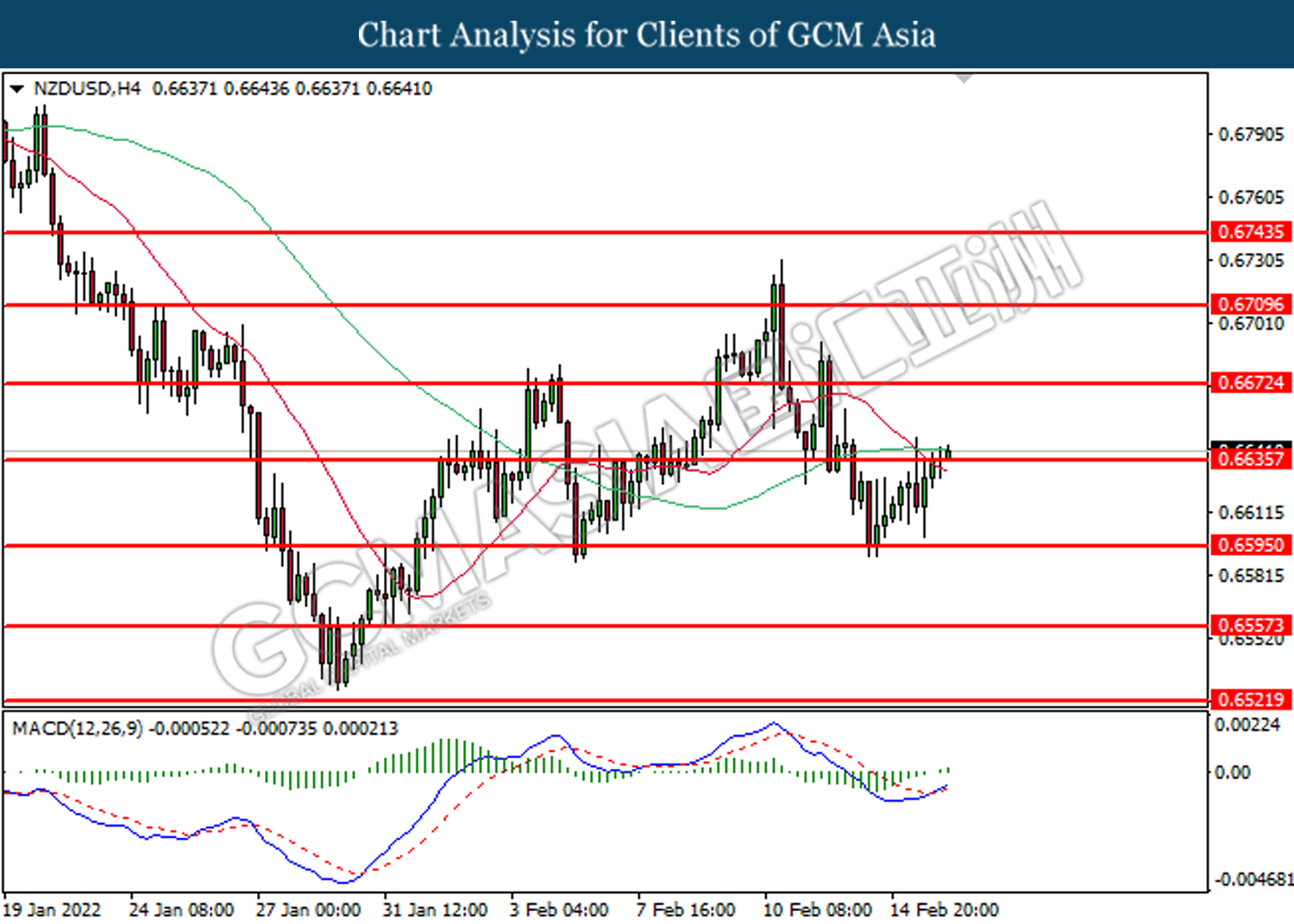

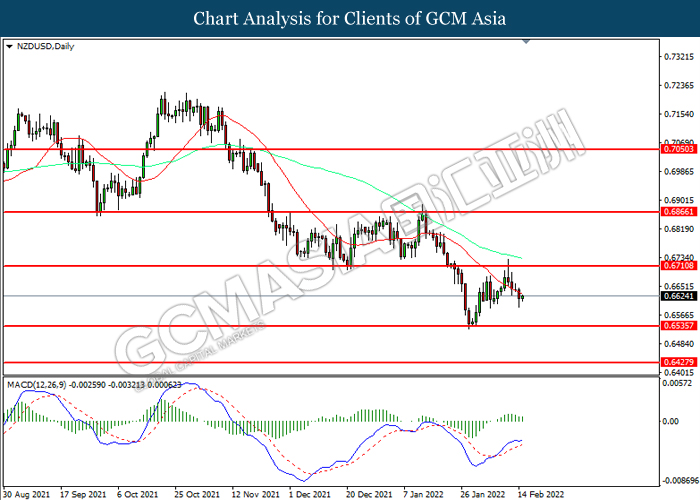

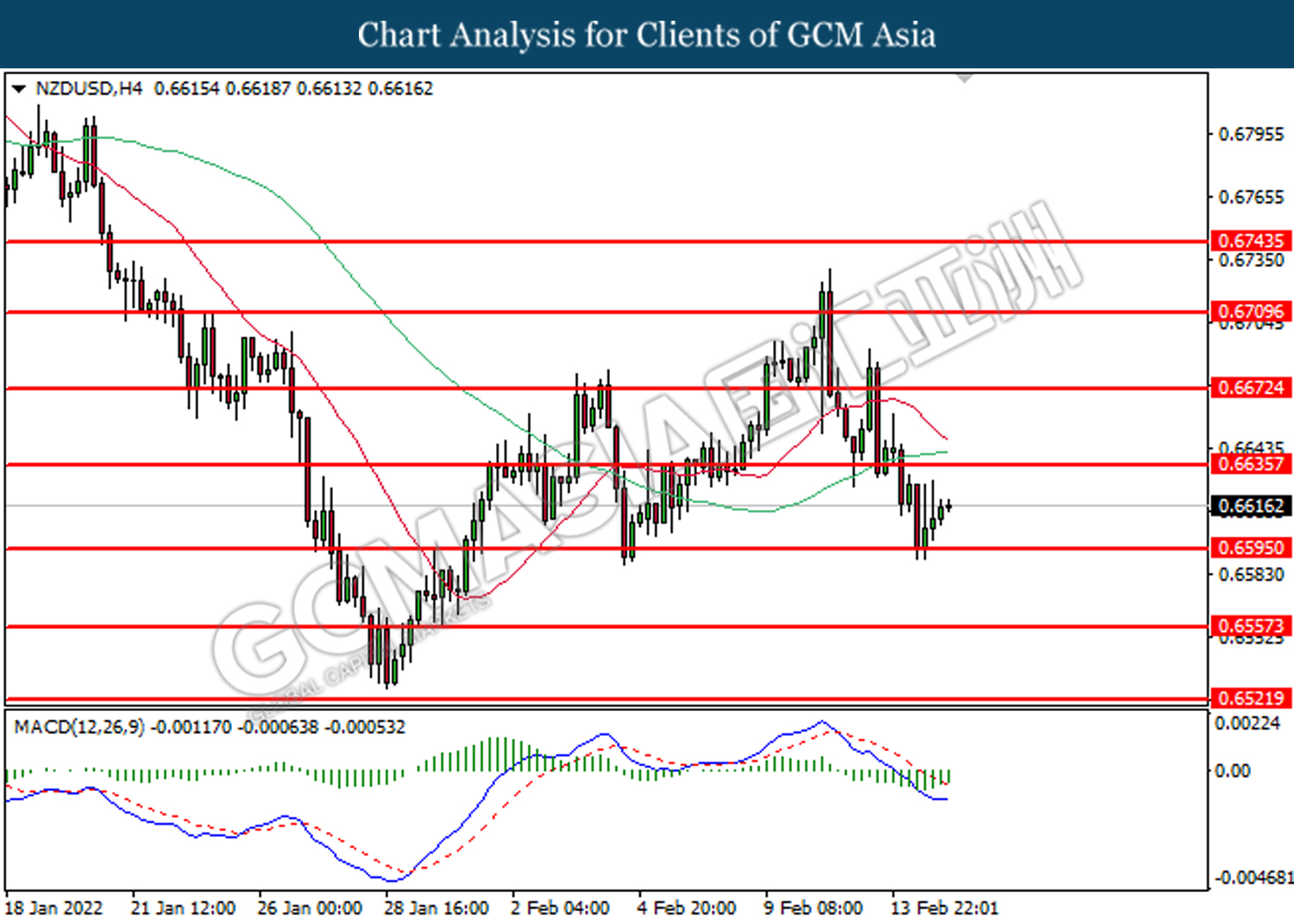

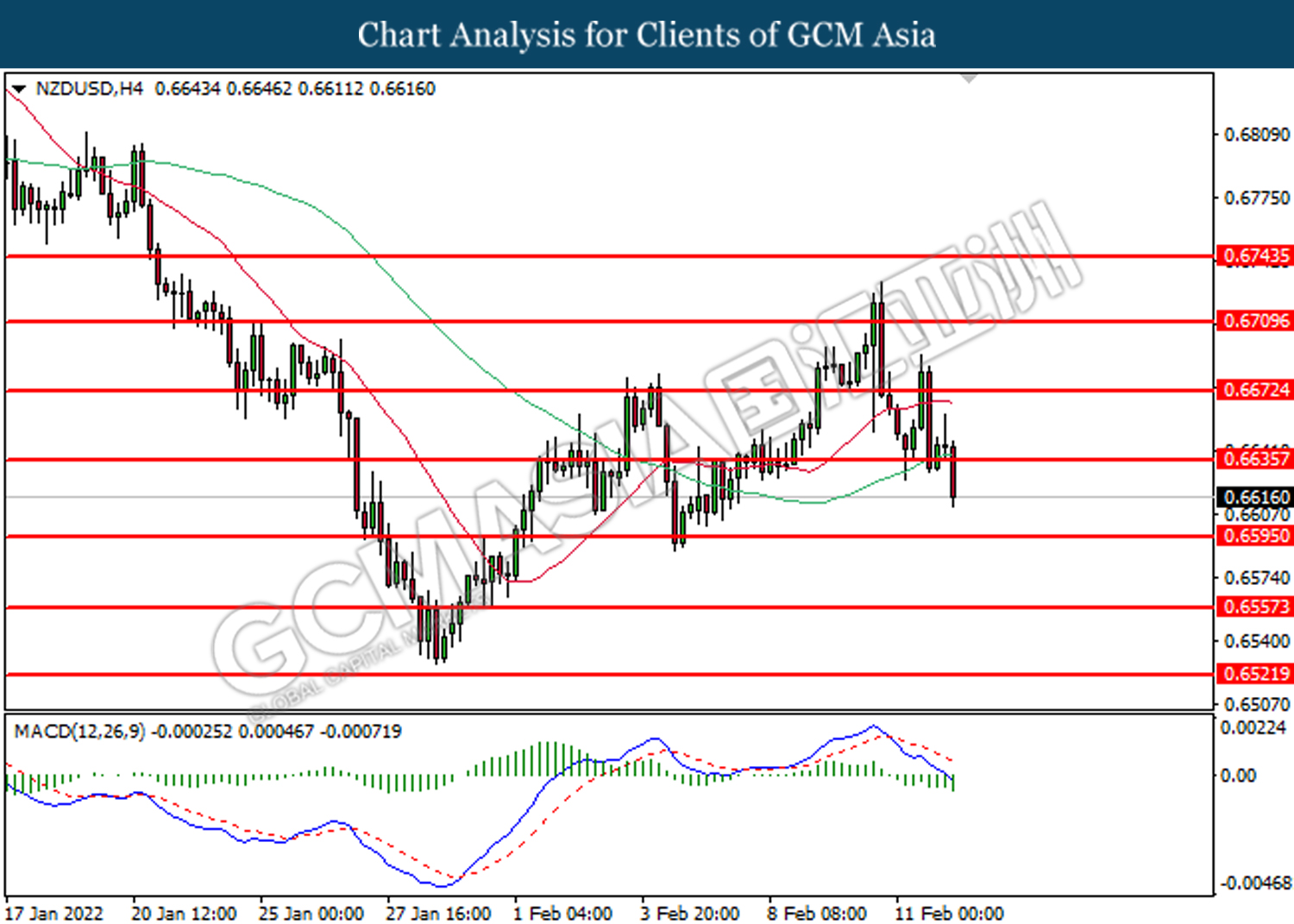

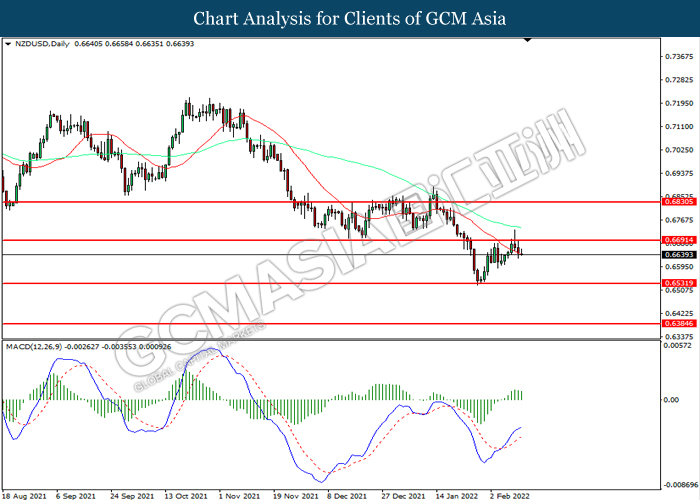

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6745, 0.6780

Support level: 0.6710, 0.6670

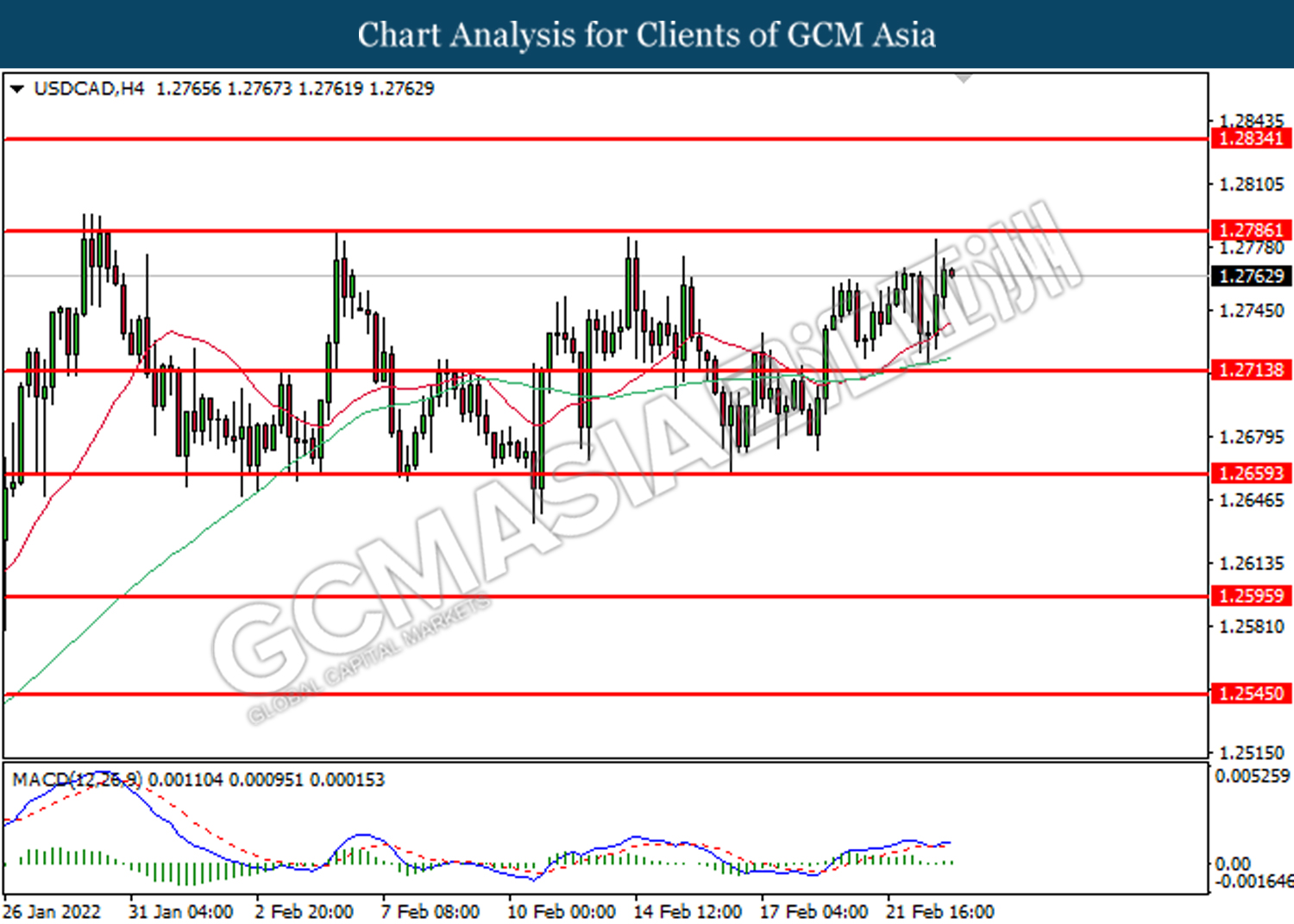

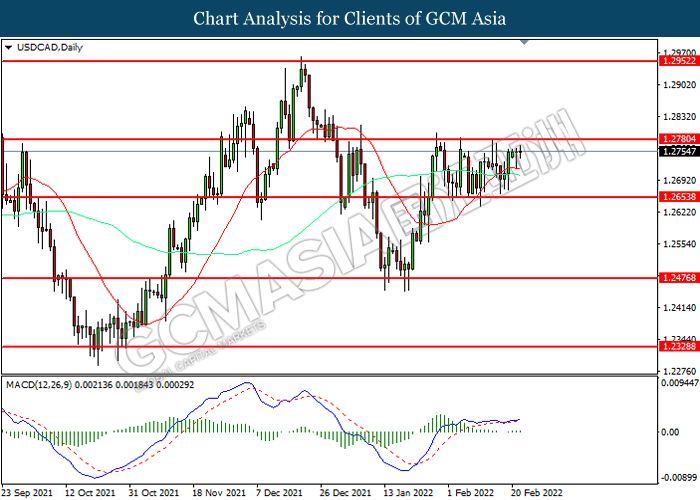

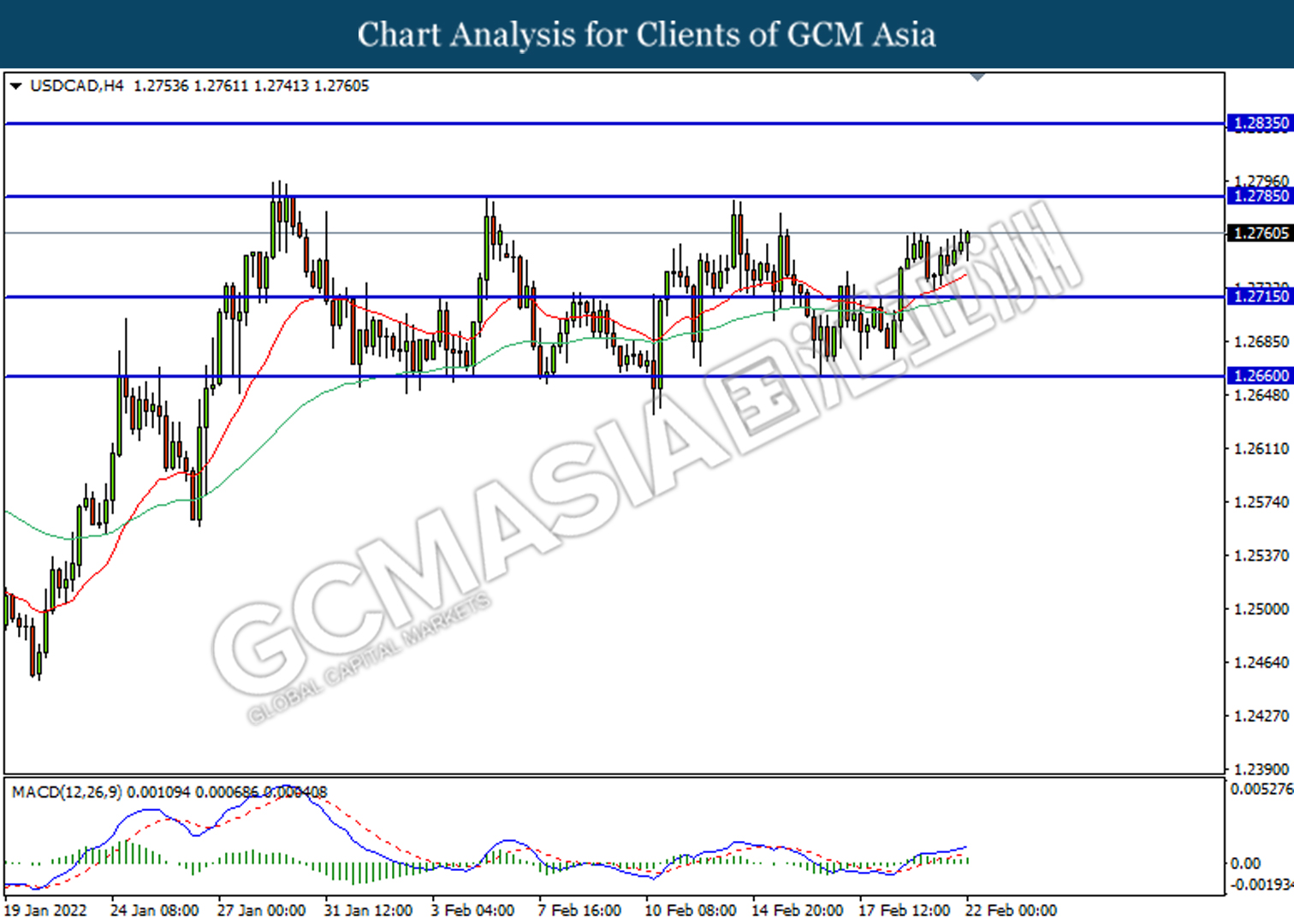

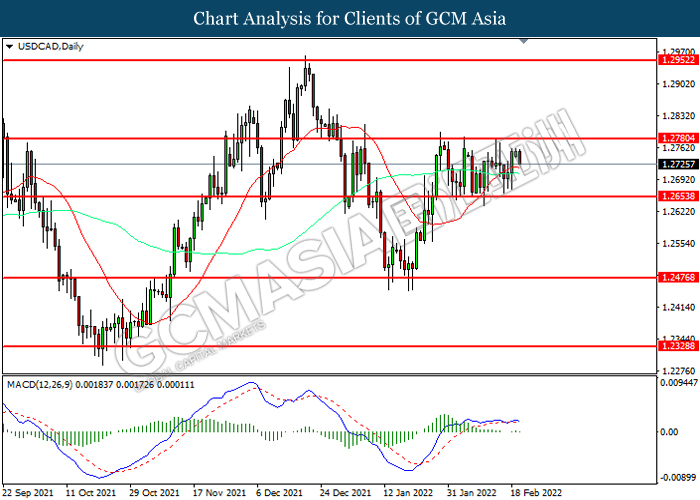

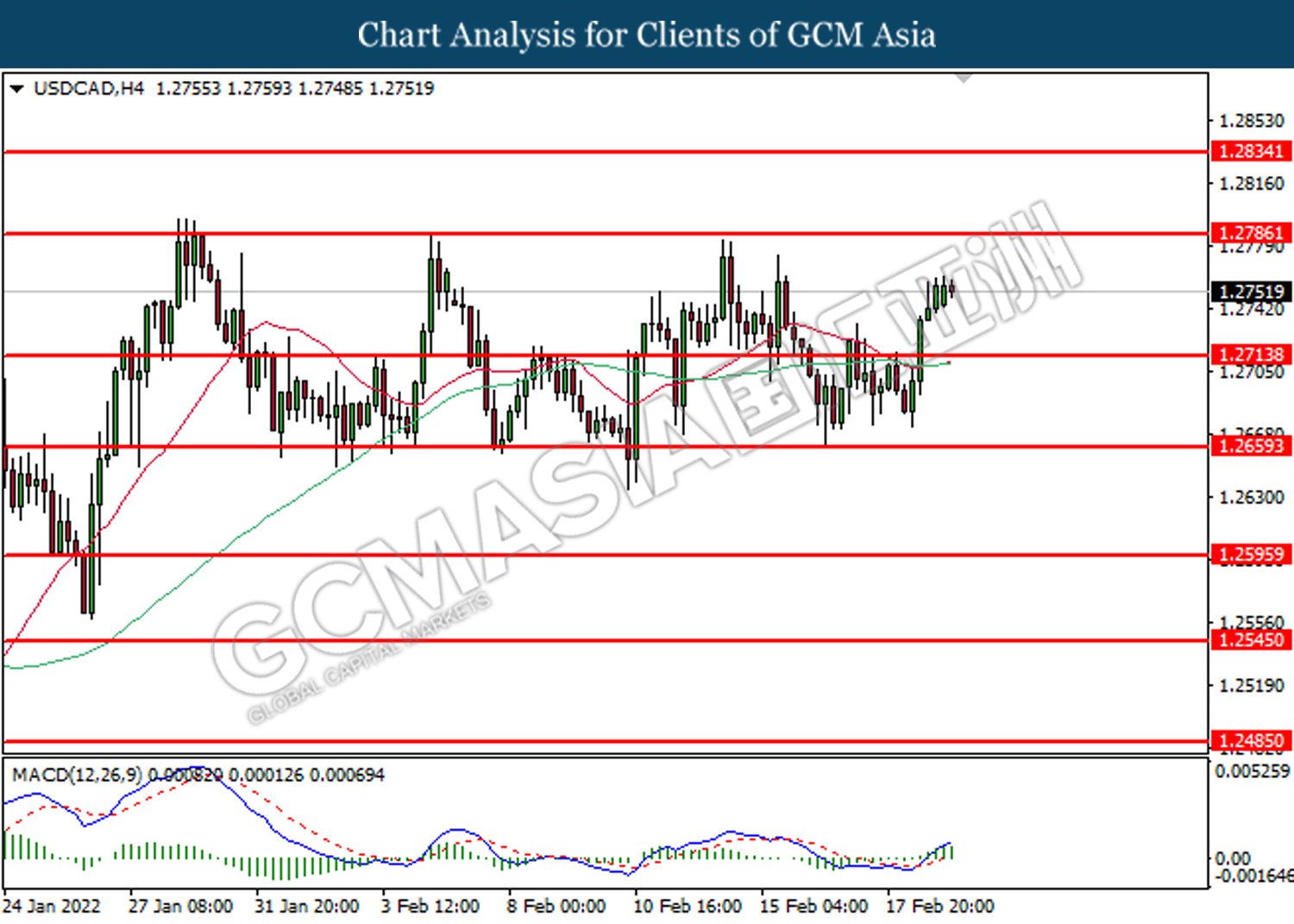

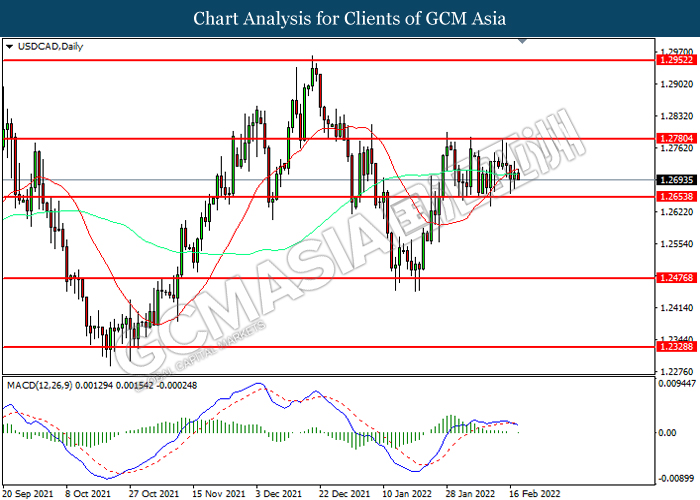

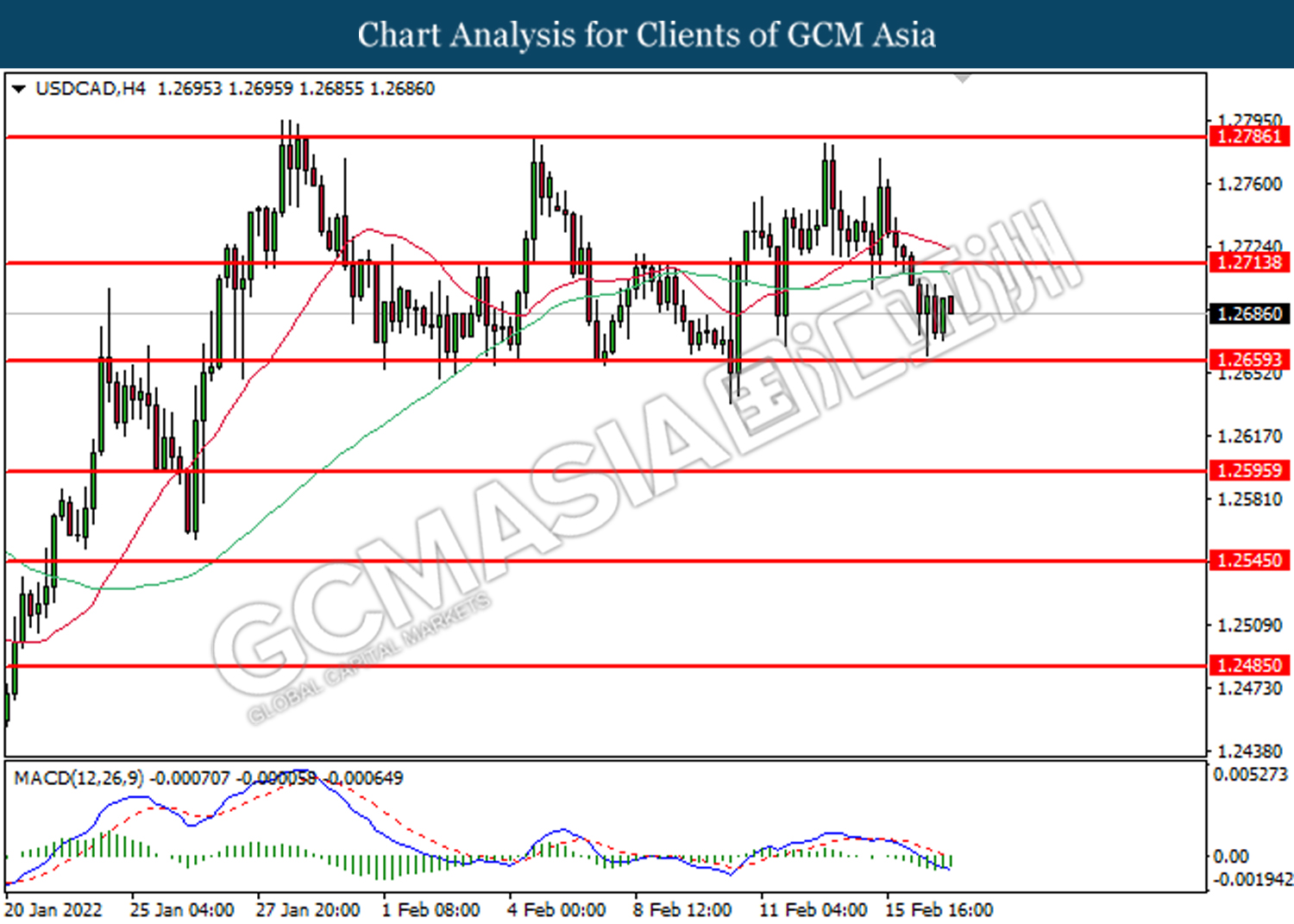

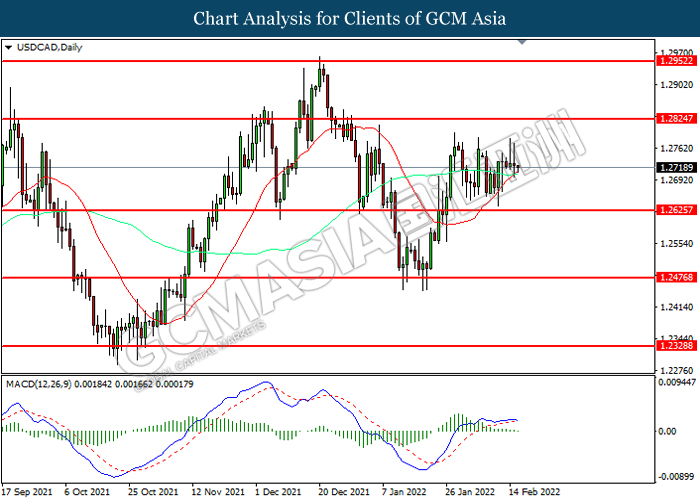

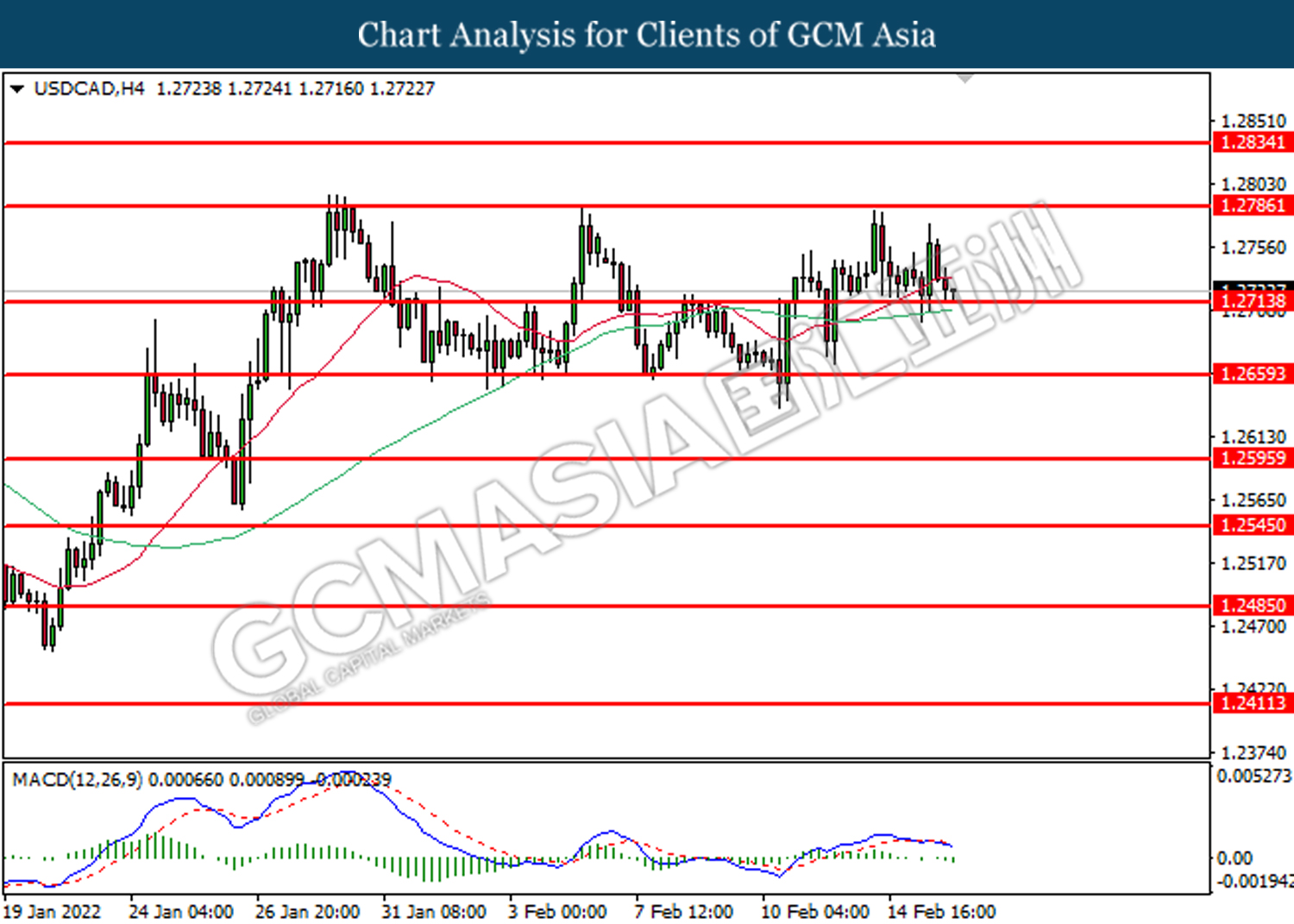

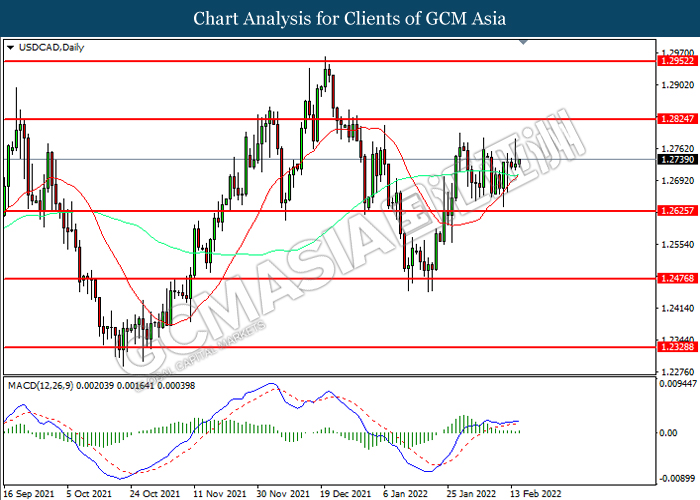

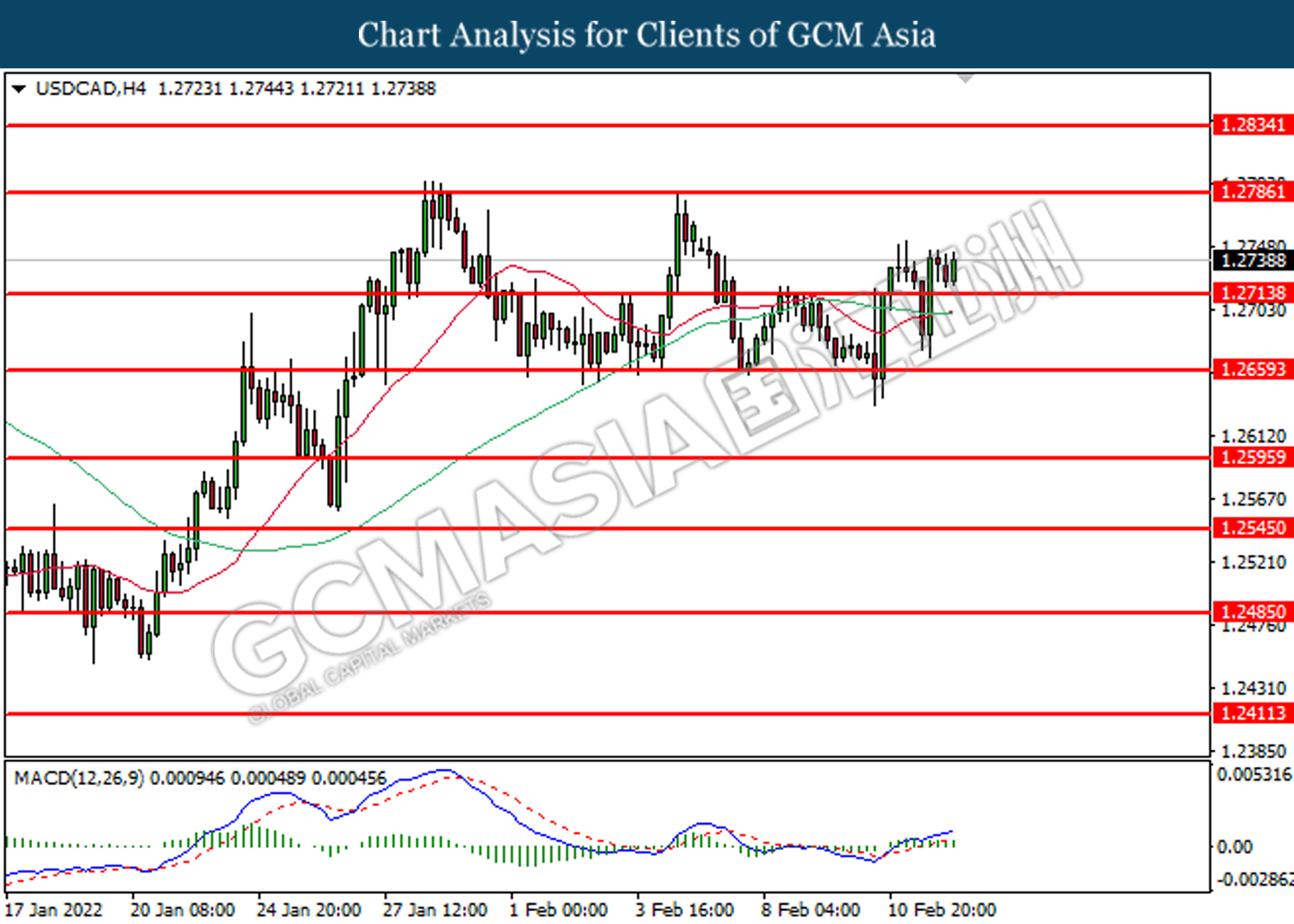

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

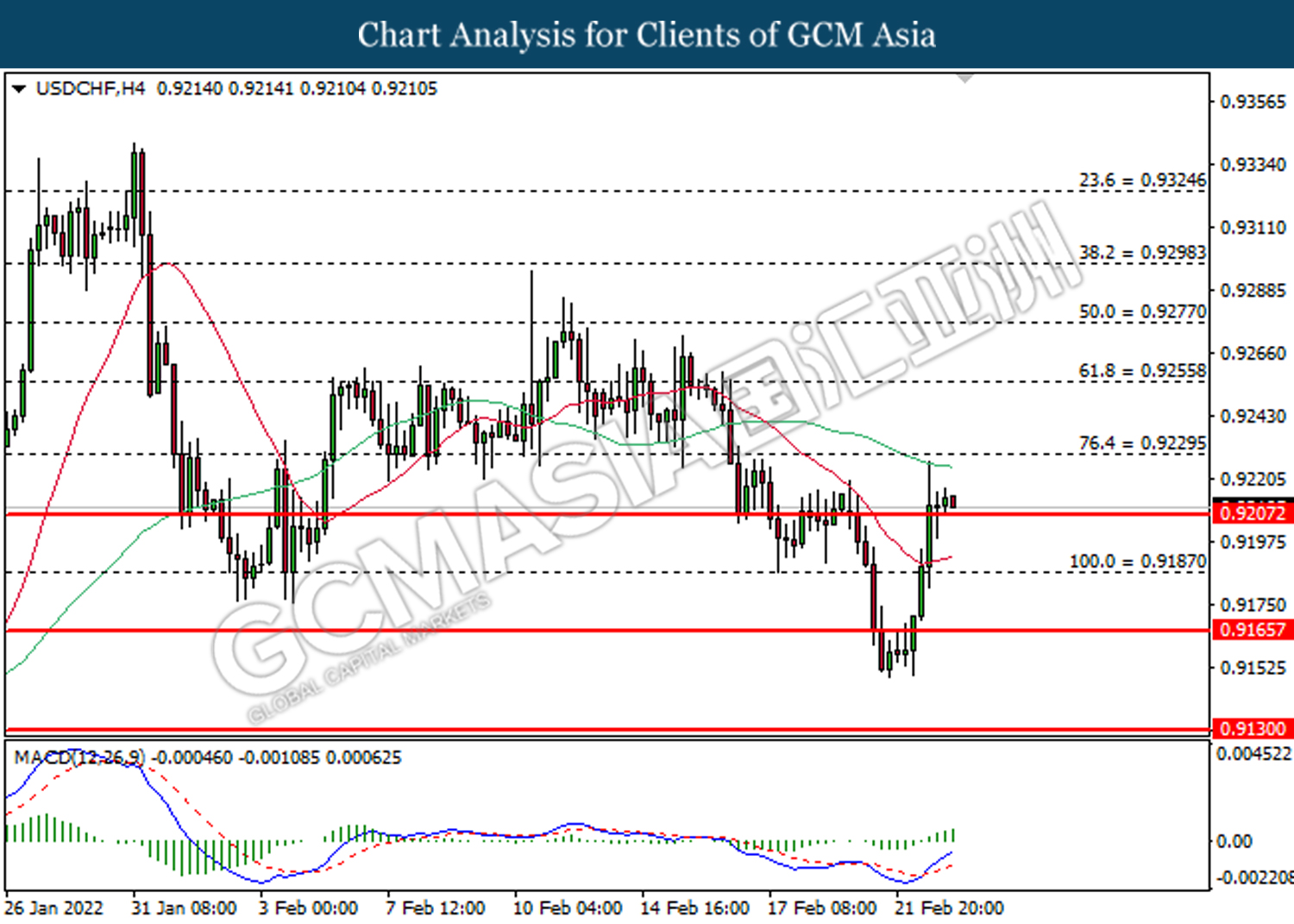

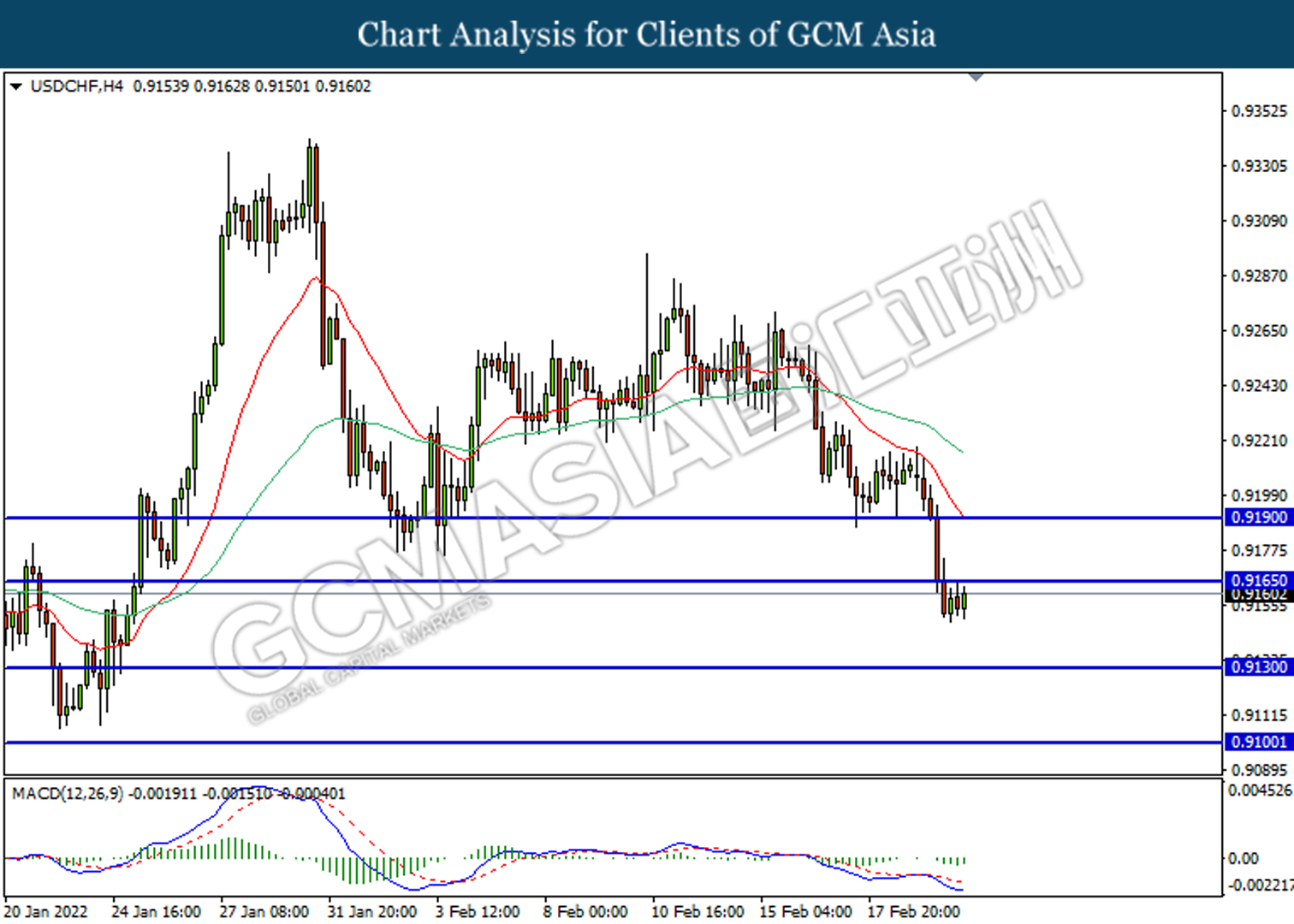

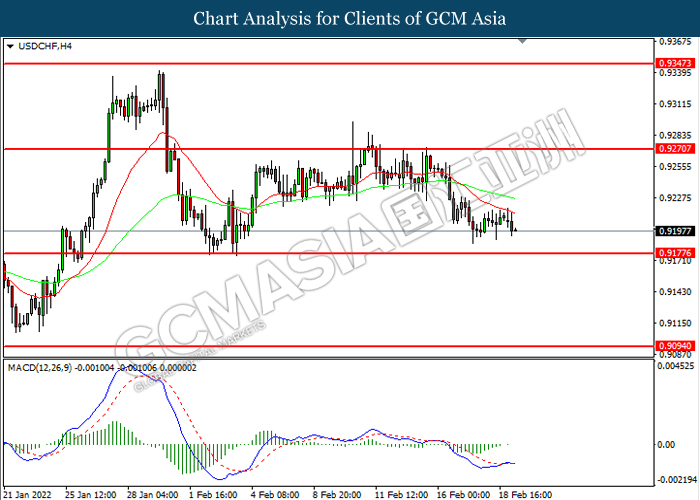

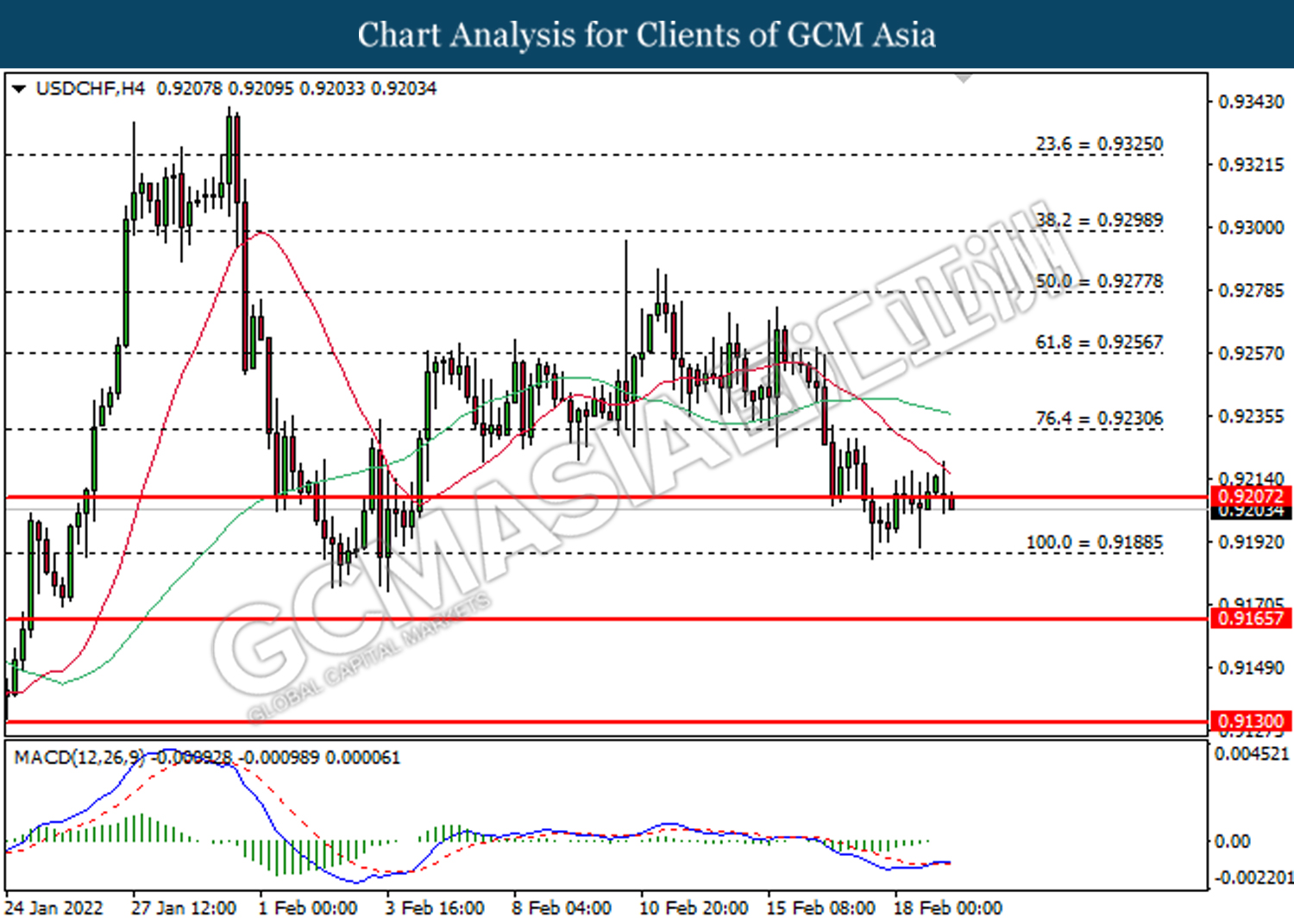

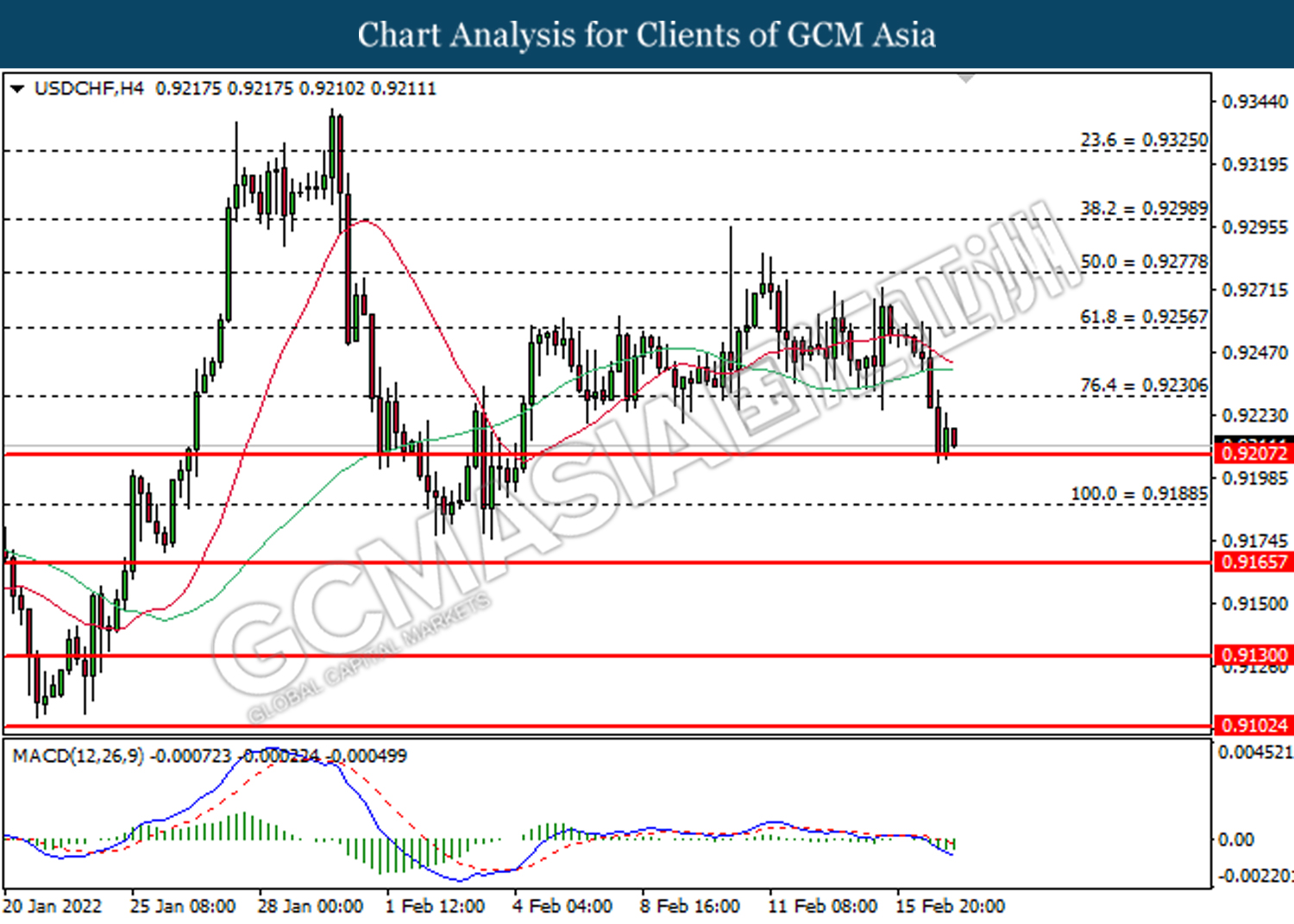

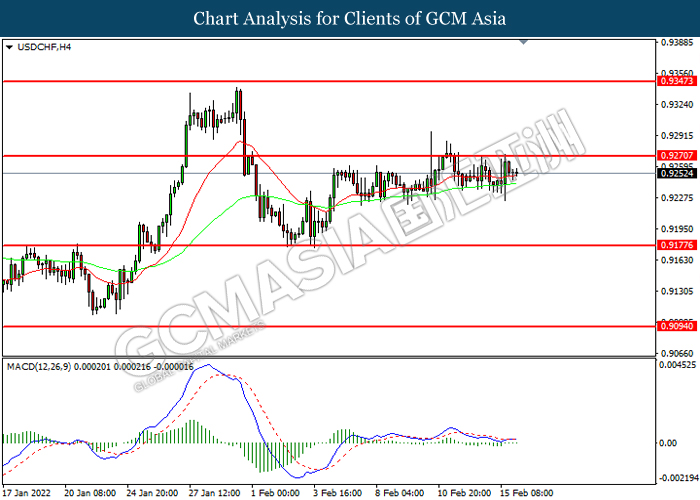

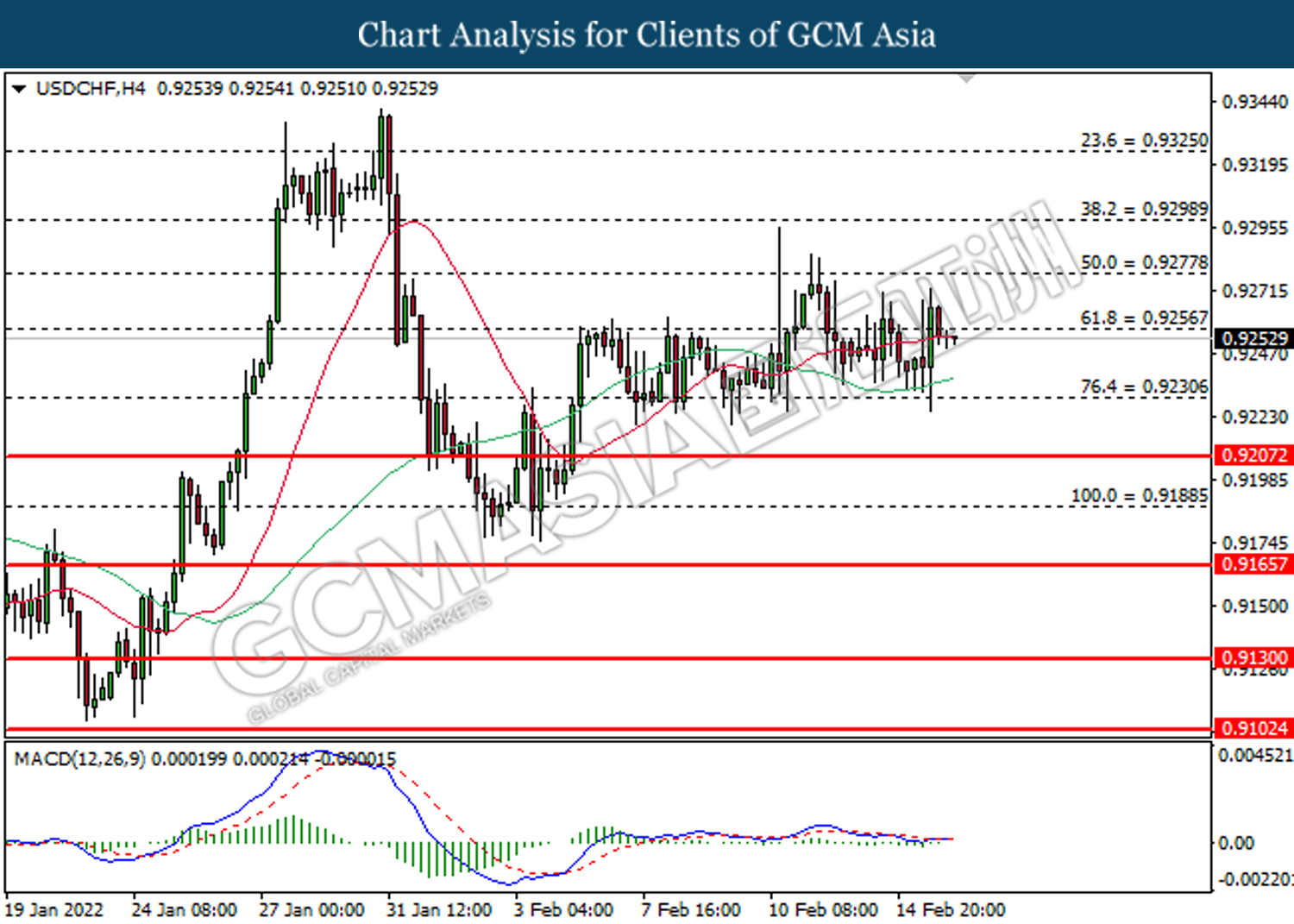

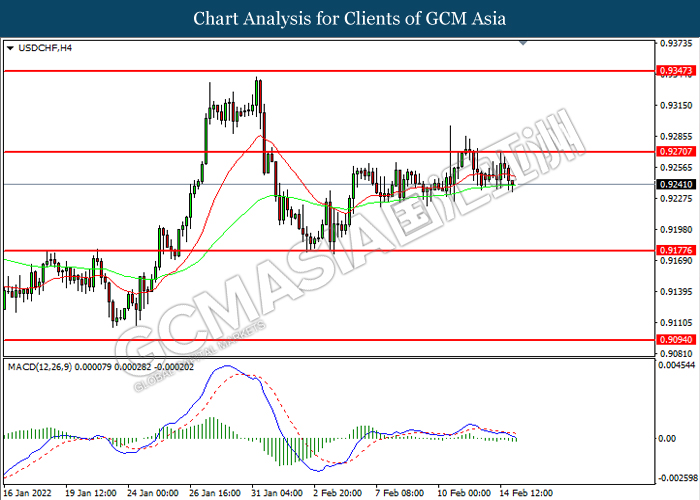

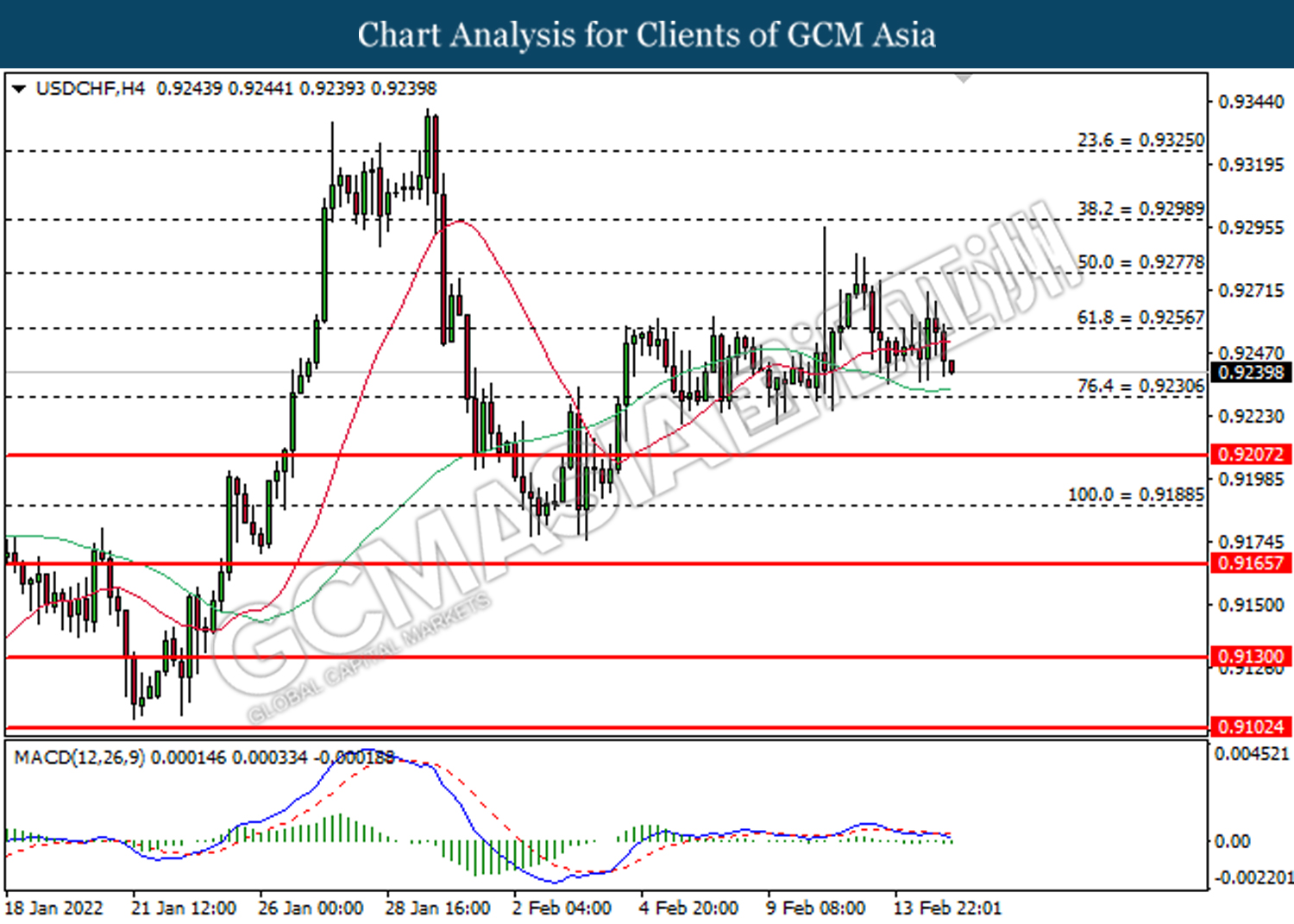

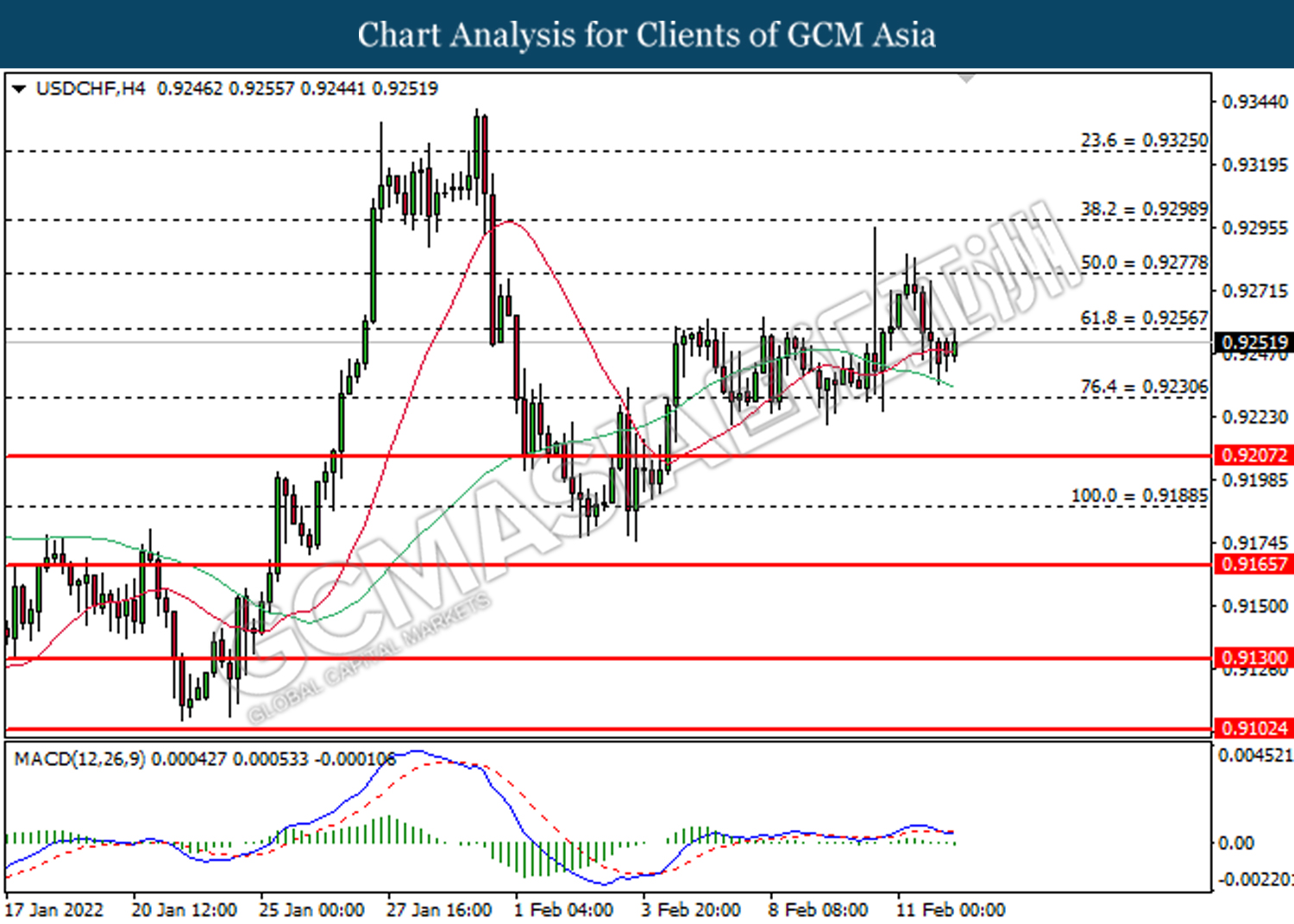

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9230, 0.9255

Support level: 0.9210, 0.9190

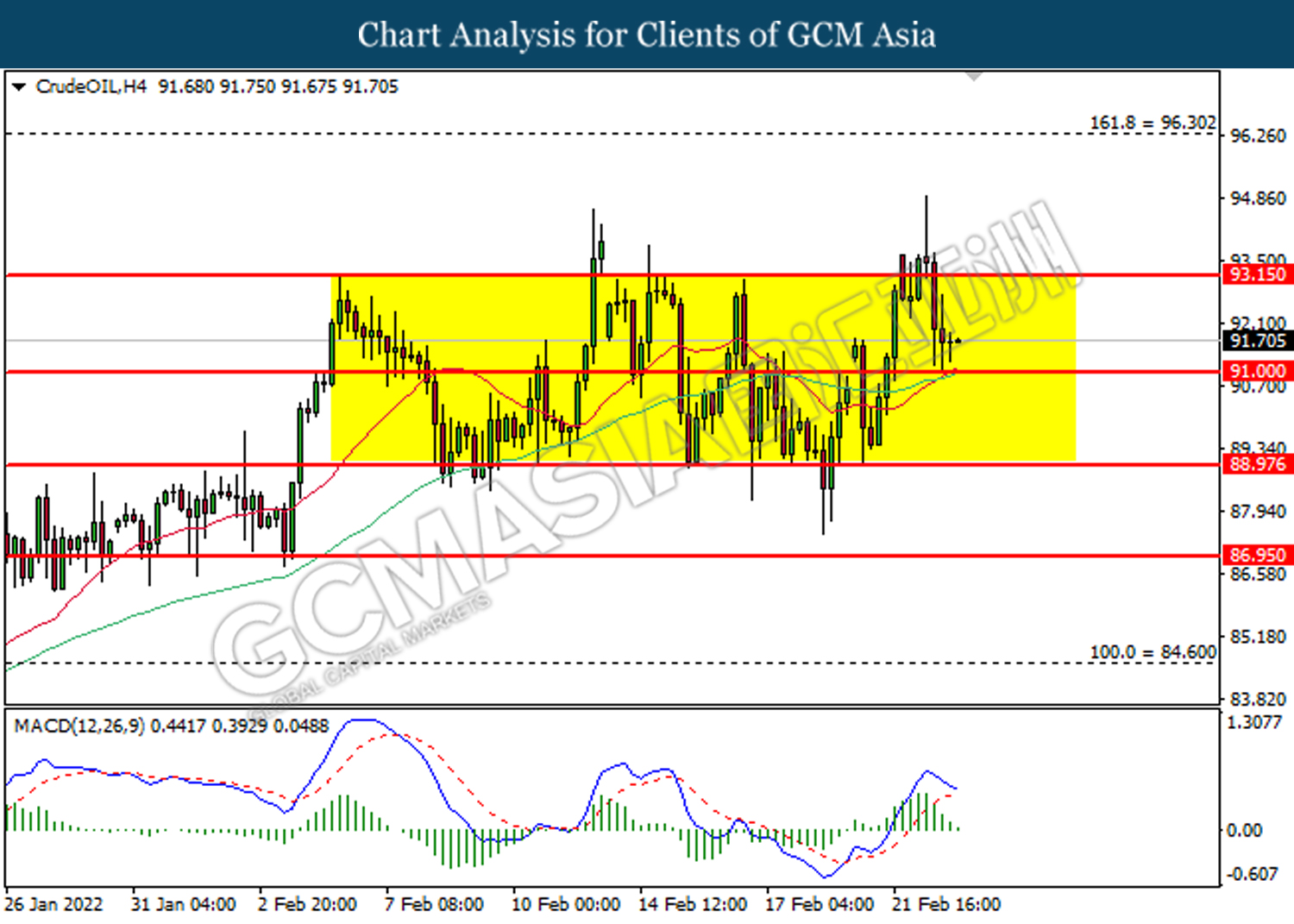

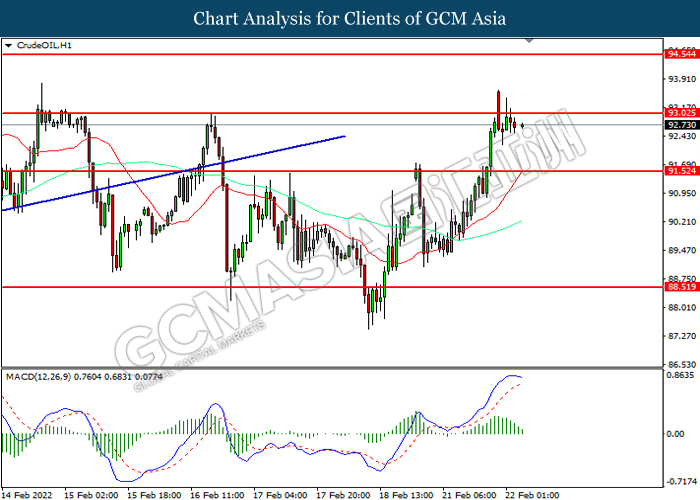

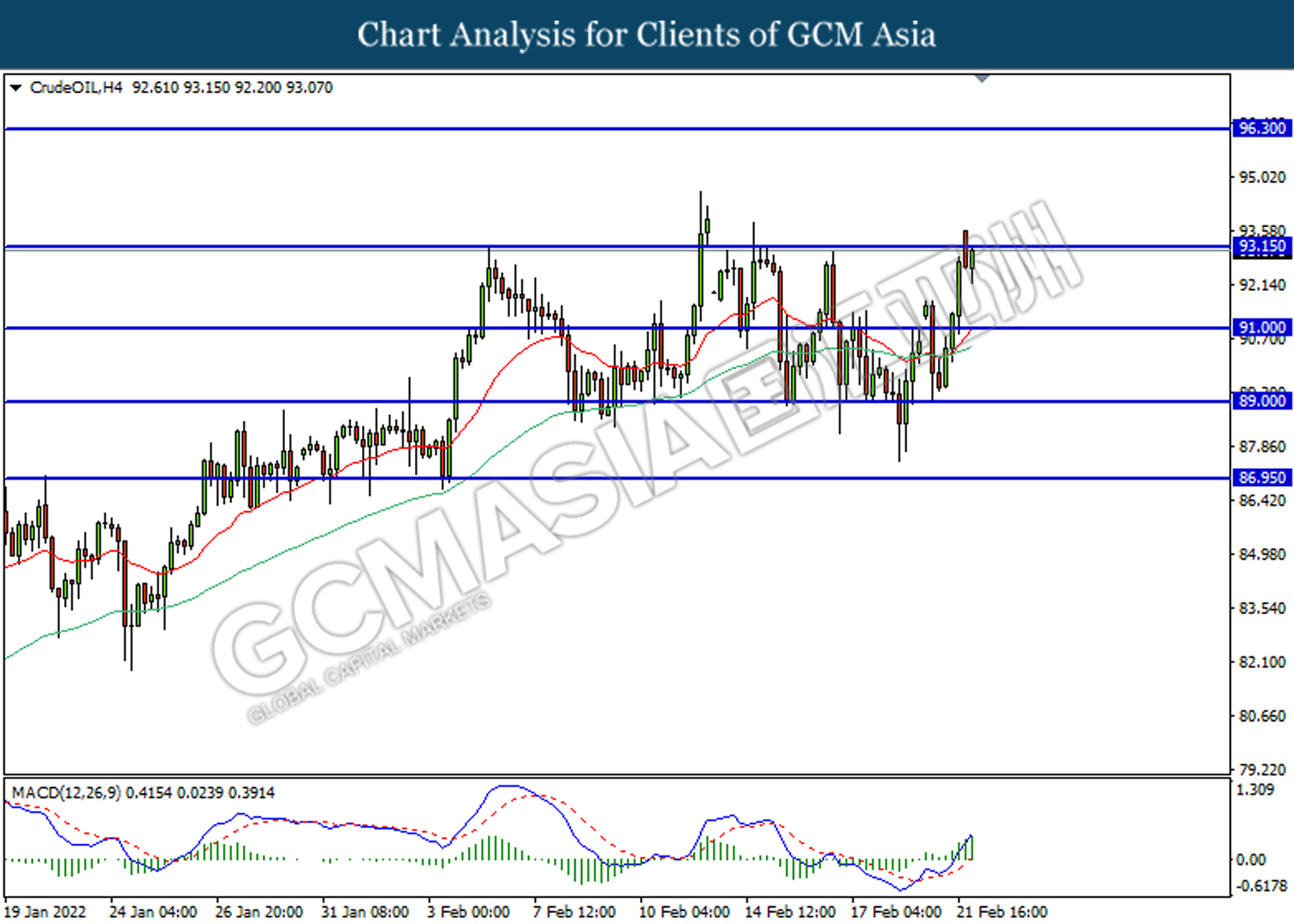

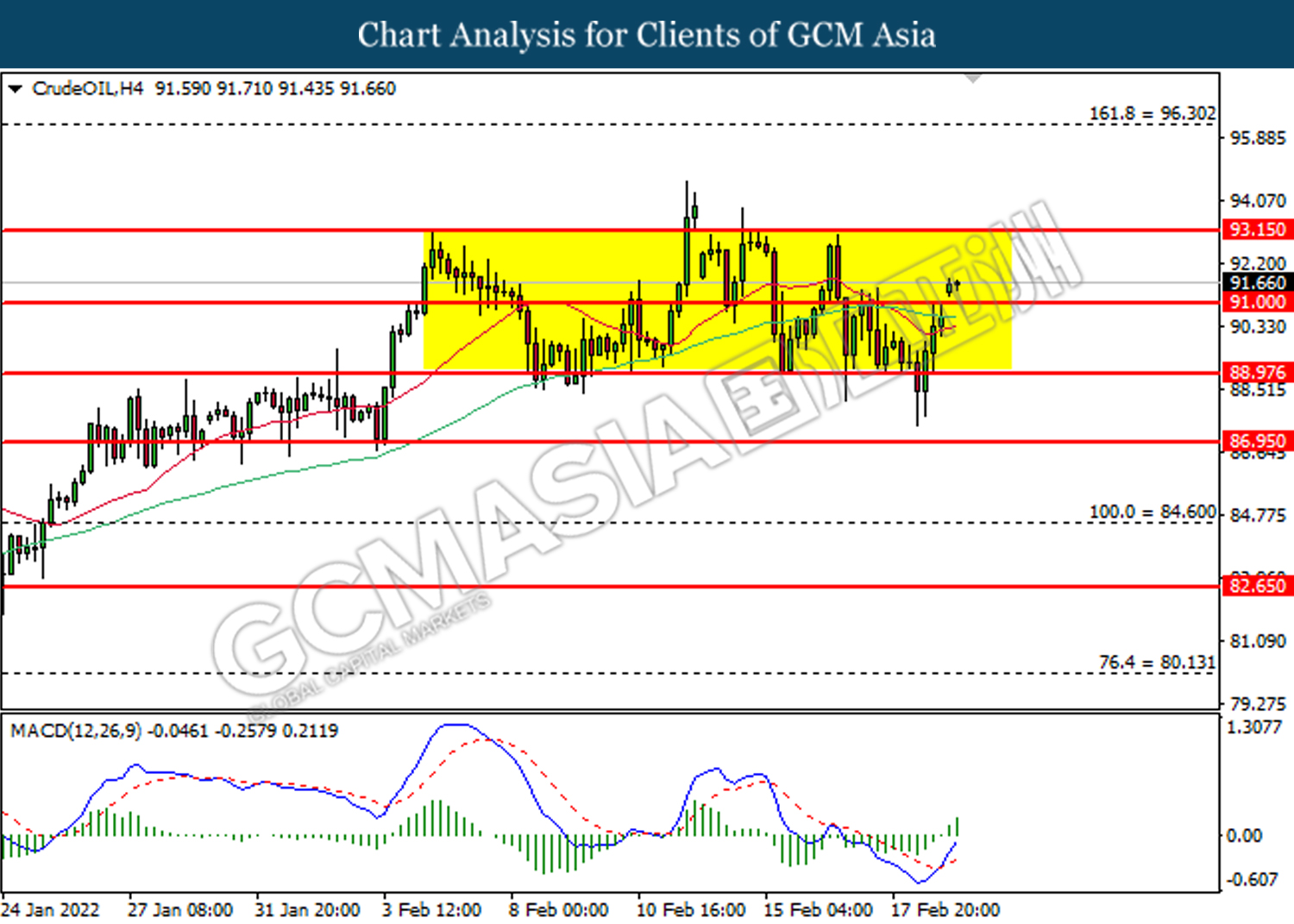

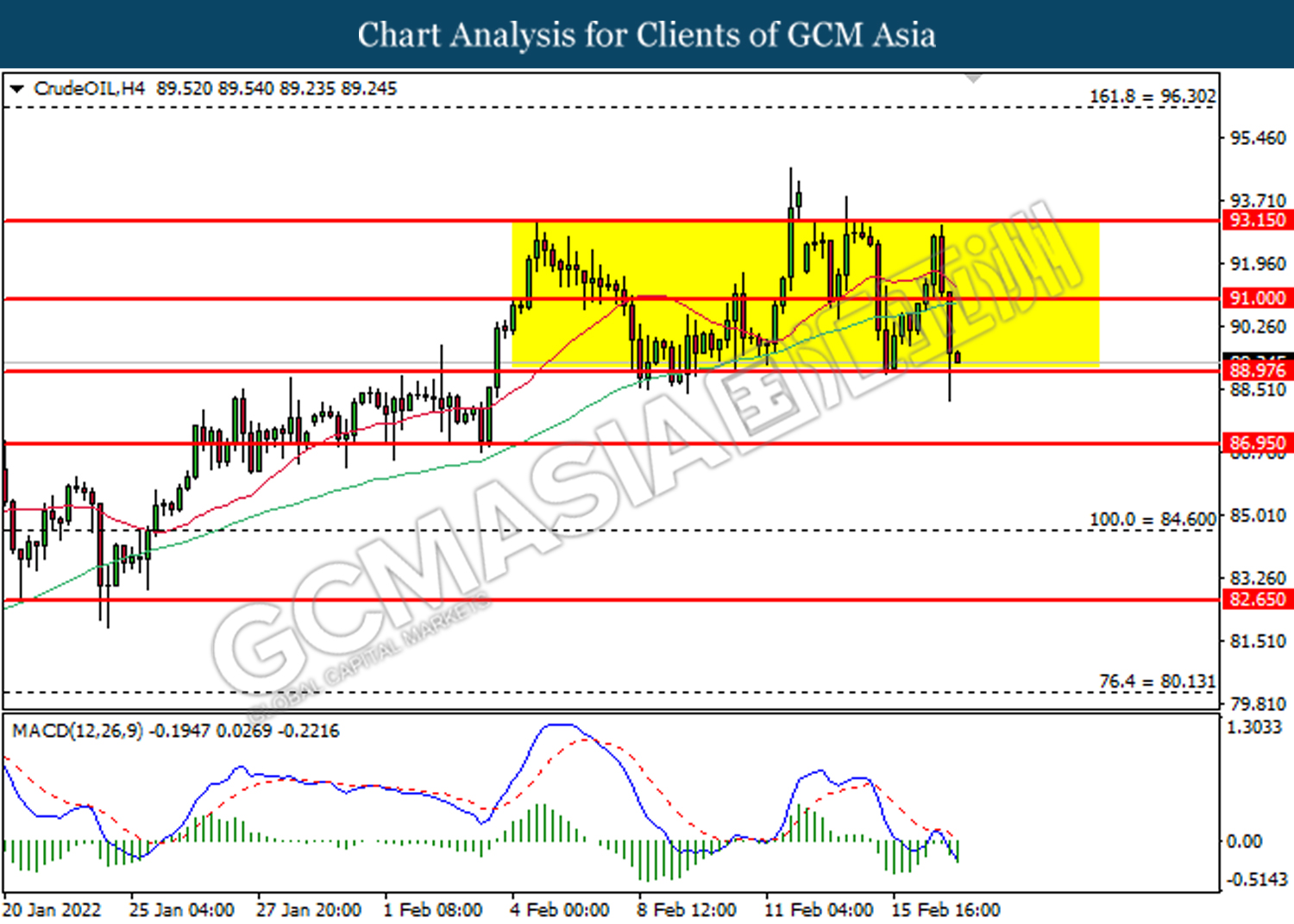

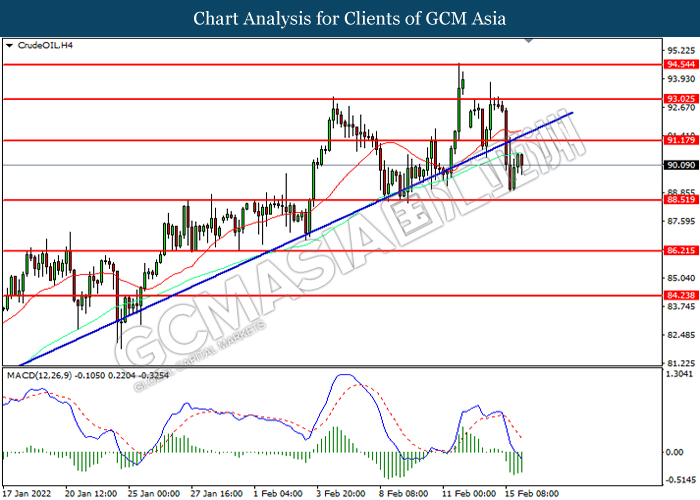

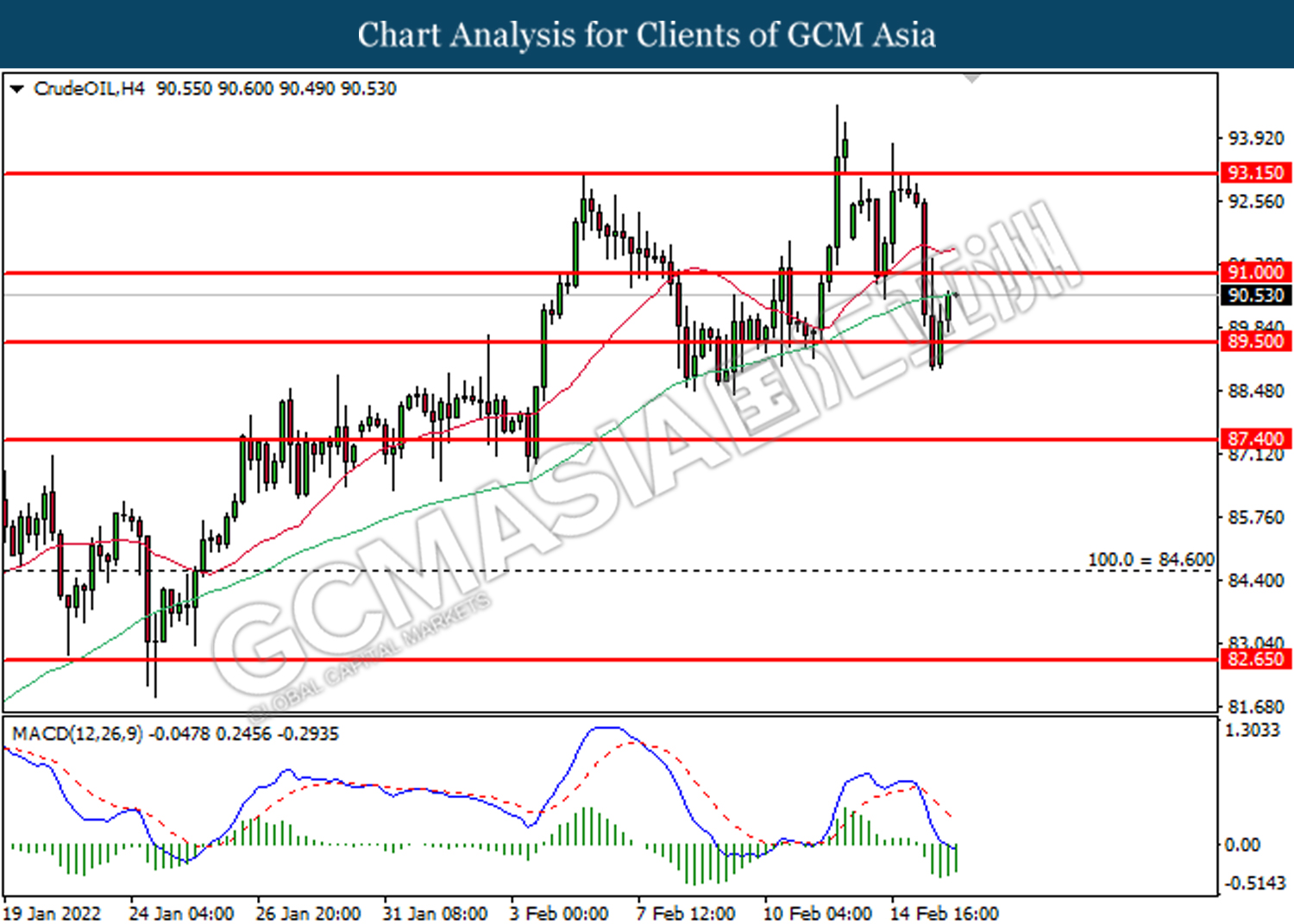

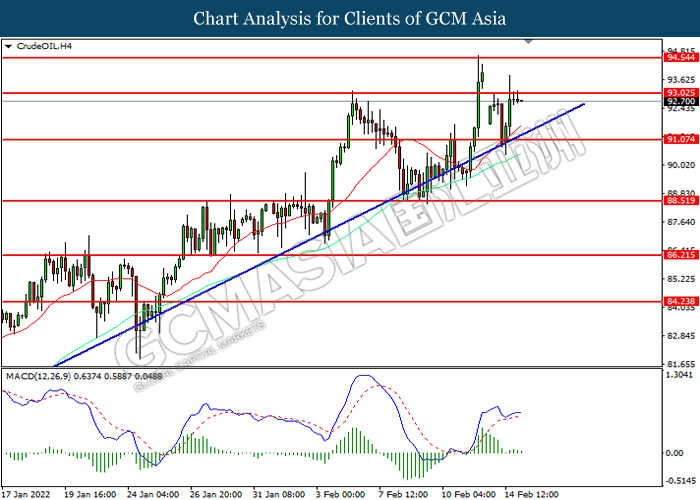

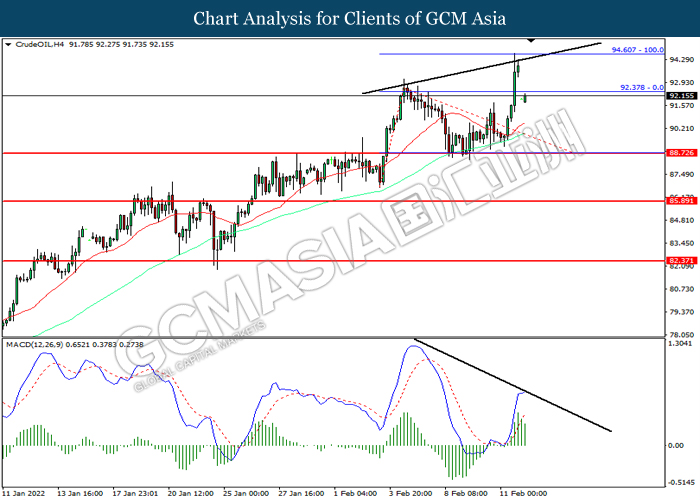

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

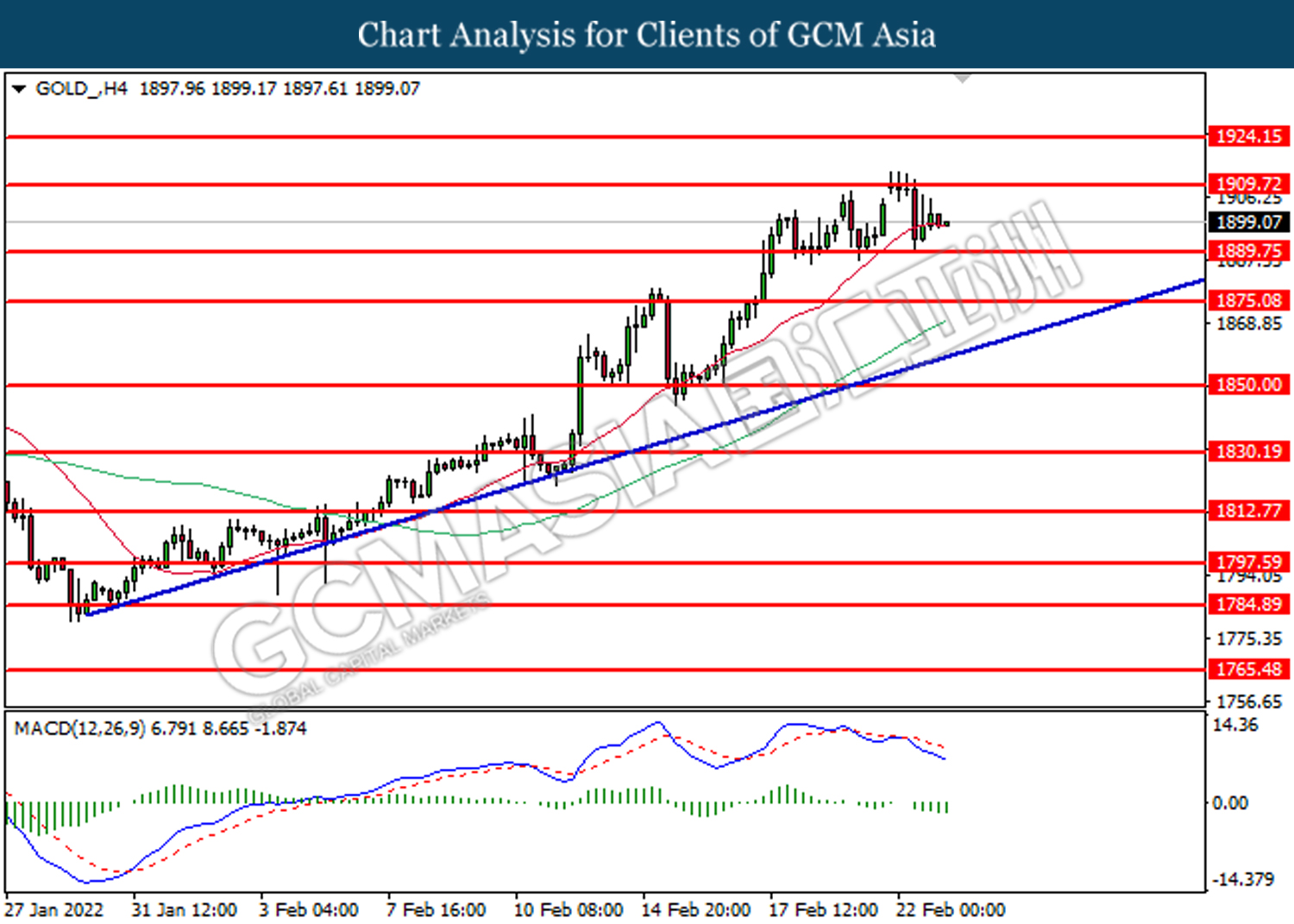

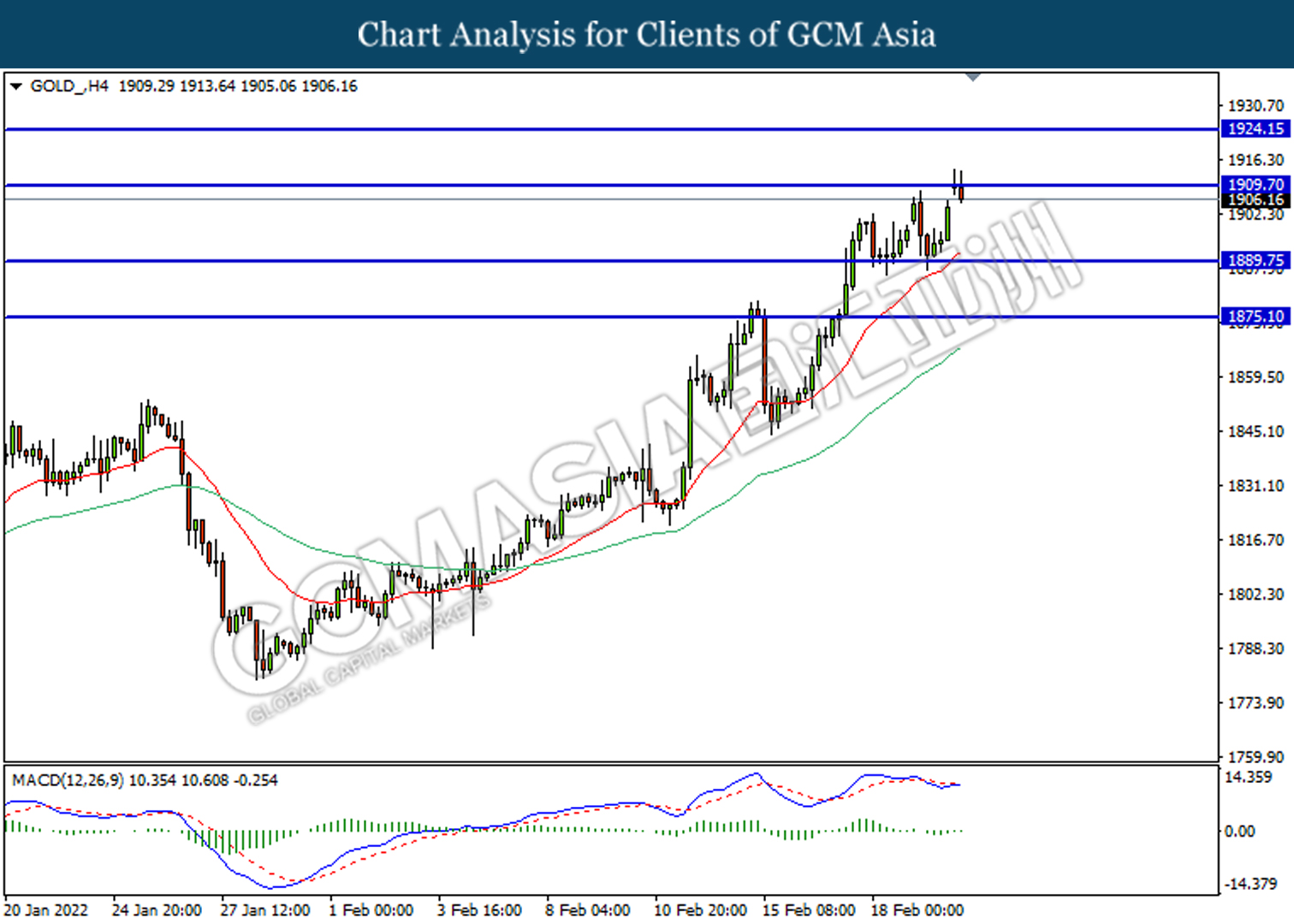

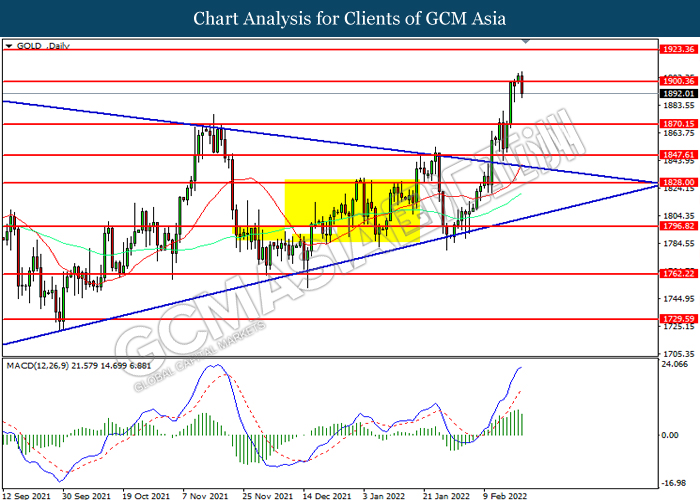

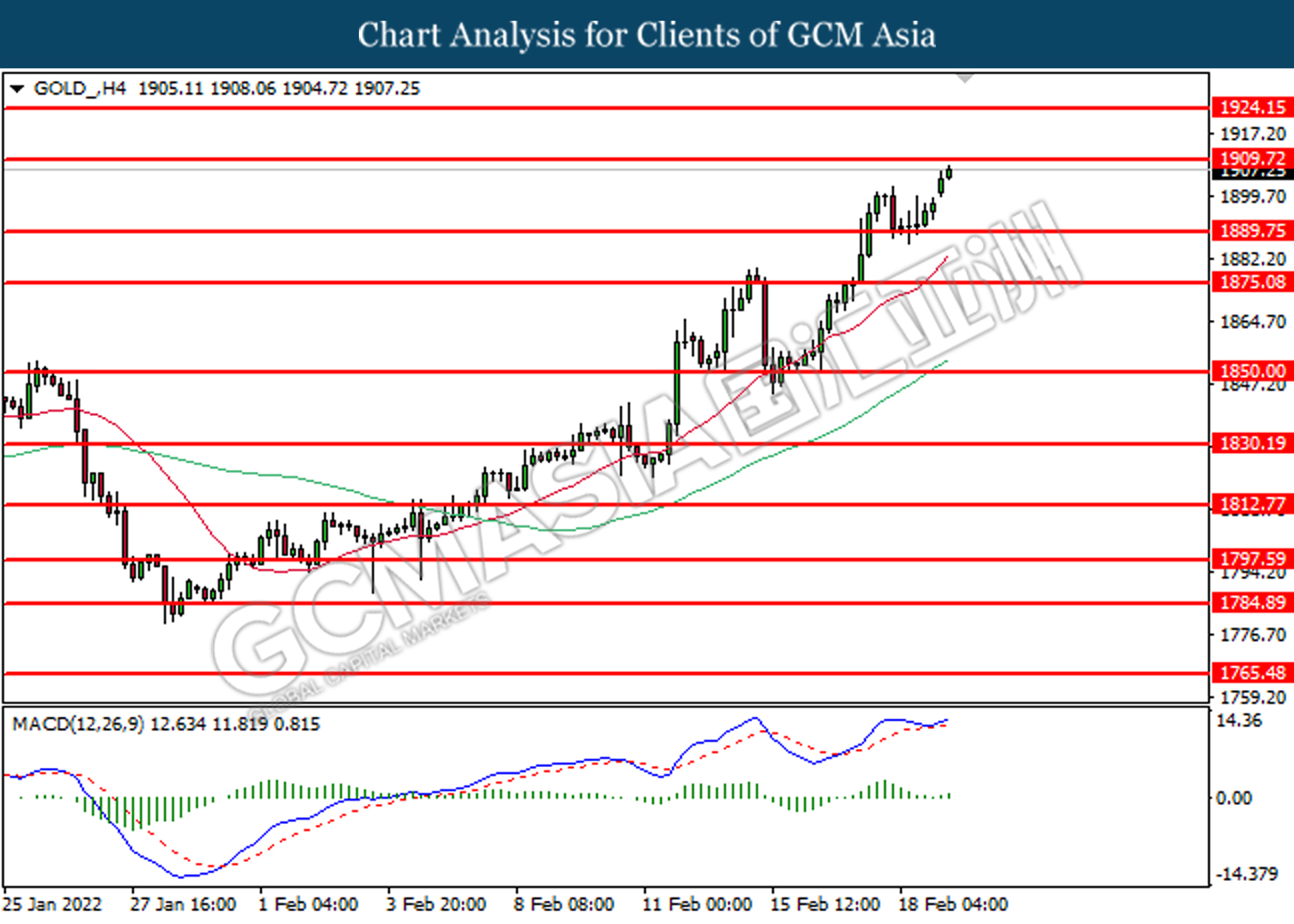

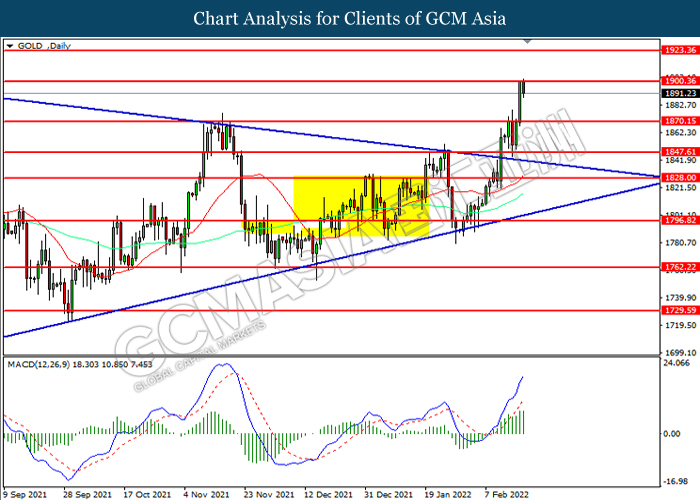

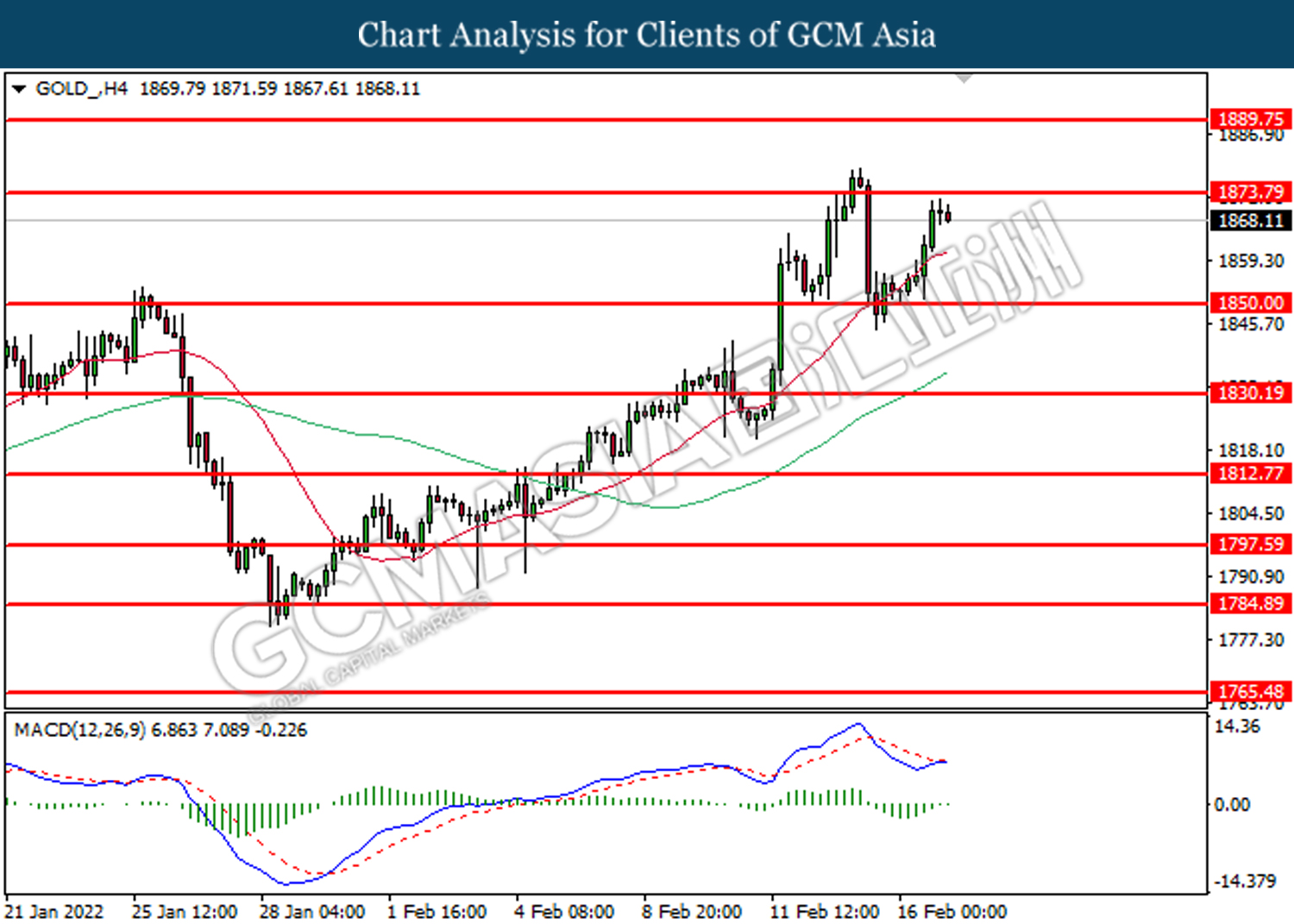

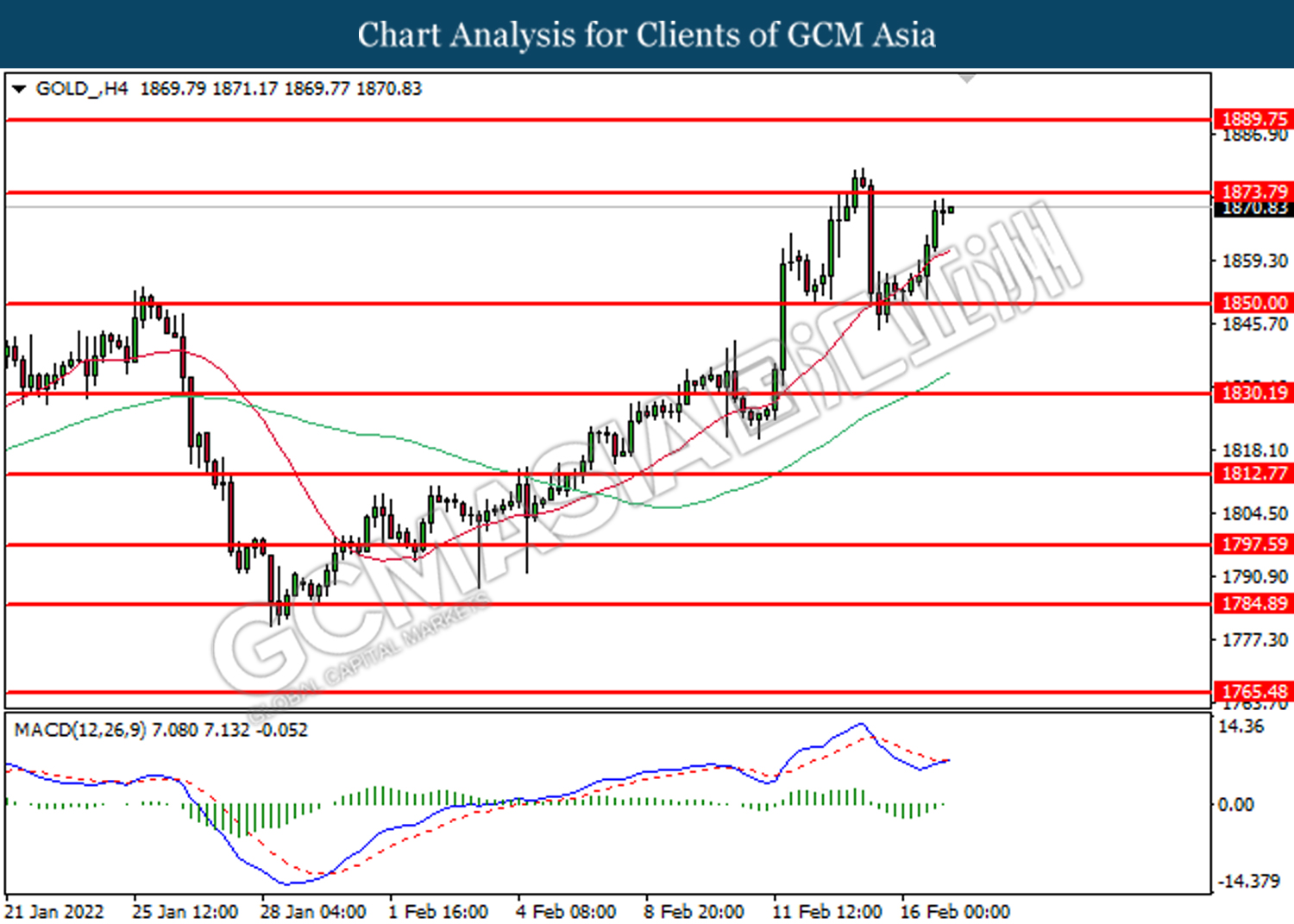

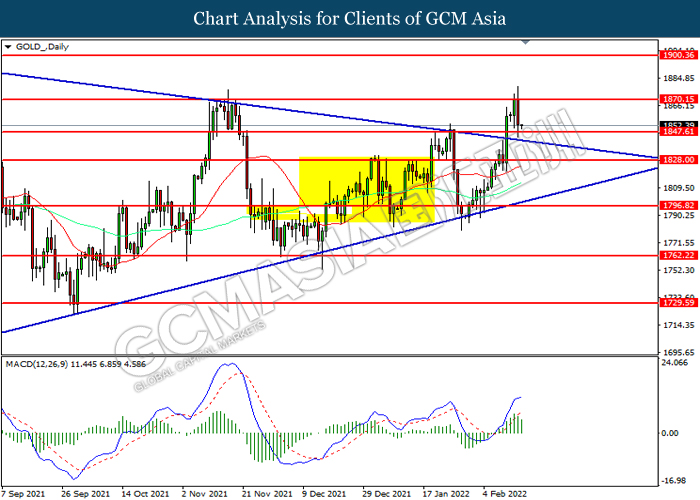

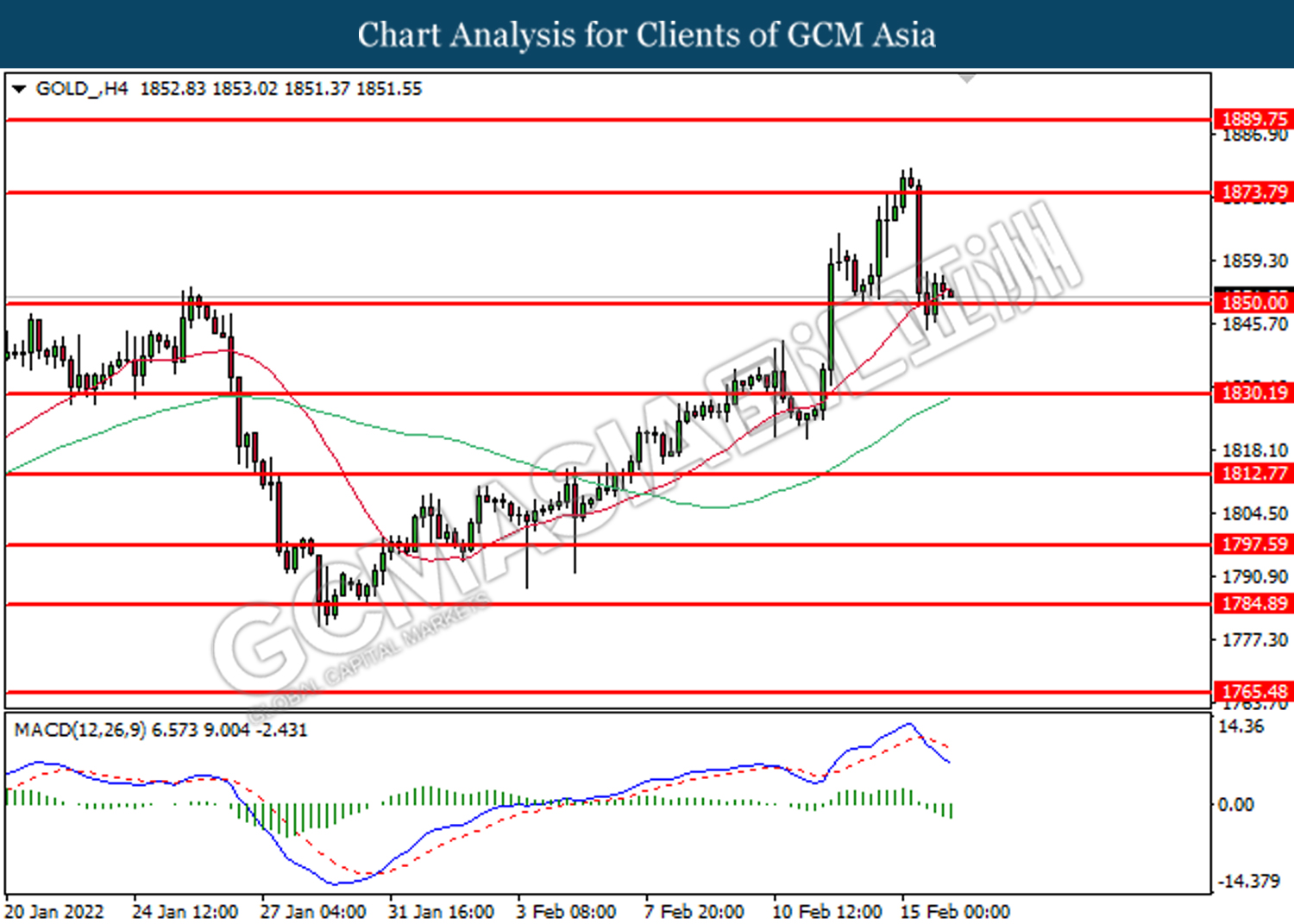

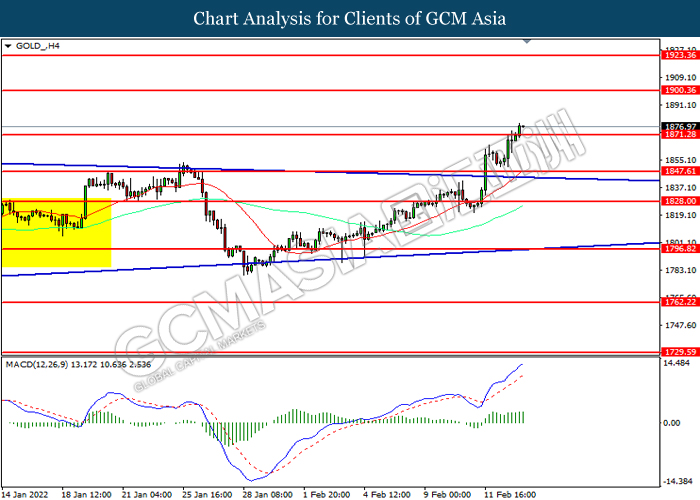

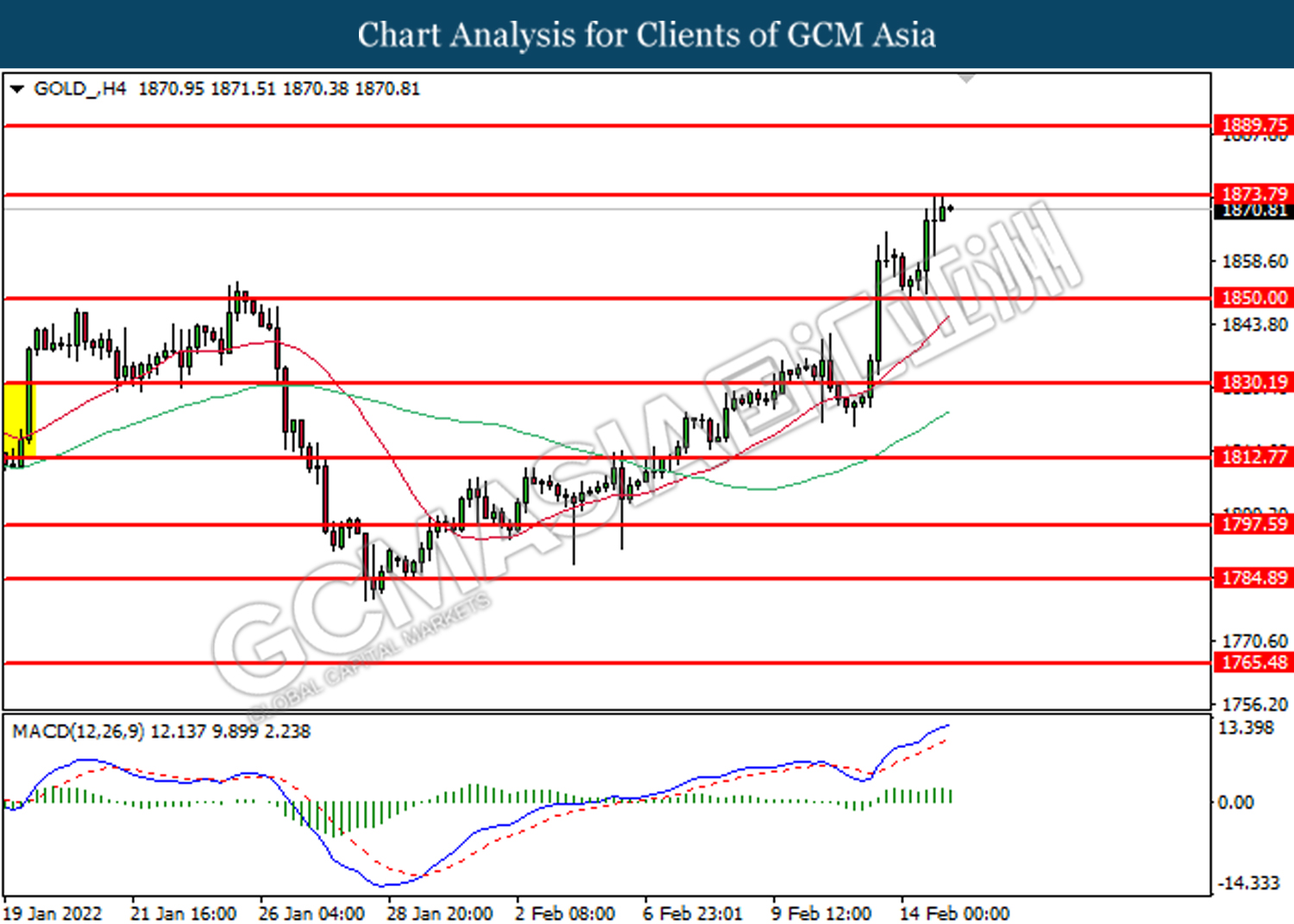

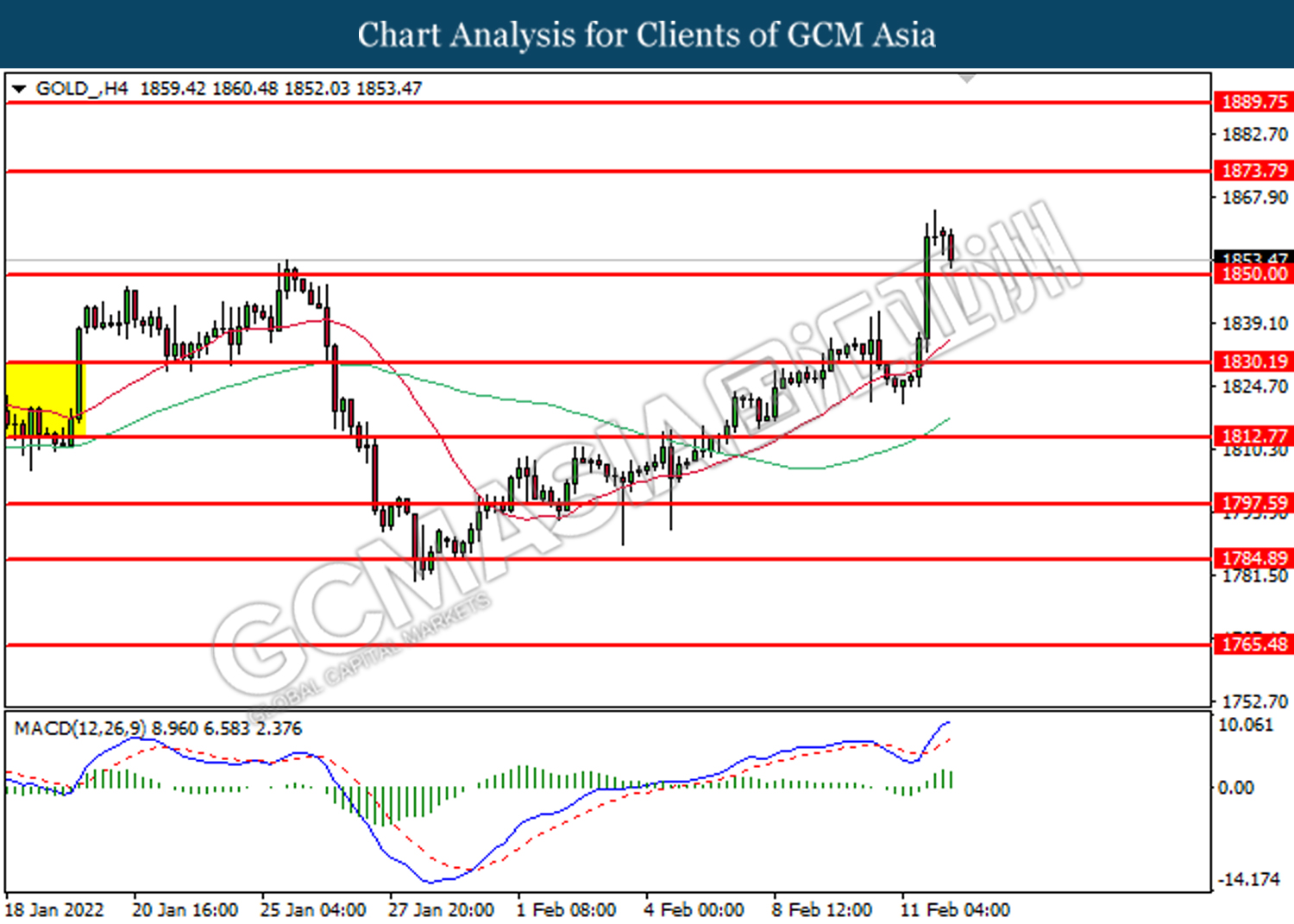

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10

220222 Afternoon Session Analysis

22 February 2022 Afternoon Session Analysis

Euro slumped amid bearish manufacturing data.

The Euro slumped over the backdrop of bearish economic data as well as rising tensions between Russian and Ukraine, which dialled down the market optimism toward the economic progression in the European region. On the economic data front, Germany Manufacturing Purchasing Managers Index (PMI) notched down from the preliminary reading of 59.8 to 58.5, missing the market forecast at 59.5, according to Markit Economics. On the other hand, the Euro extend its losses amid rising geopolitical tensions around the world had stoked a shift in sentiment toward risk-free asset, which dragging down the appeal for the risky currency such as Euro. According to Reuters, Putin on Monday recognised two breakaway regions in eastern Ukraine as independent while ordering the Russian army to enter Ukraine, spurring concerns upon the major war between Russia-Ukraine. As of writing, EUR/USD depreciated by 0.16% to 1.1290.

In the commodities market, the crude oil price depreciated by 0.31% to 94.20 per barrel as of writing amid technical correction following it reached record high recently. On the other hand, the safe-haven gold surged 0.22% to $1909.40 per troy ounces as of writing amid rising geopolitical tensions between Russia-Ukraine had diminished the risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 95.7 | 96.5 | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 113.8 | 109.8 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 95.95. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 96.80.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3615. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3505.

Resistance level: 1.3615, 1.3730

Support level: 1.3505, 1.3440

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1290. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 115.40. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 114.30.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7205. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6715, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2780. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9095.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

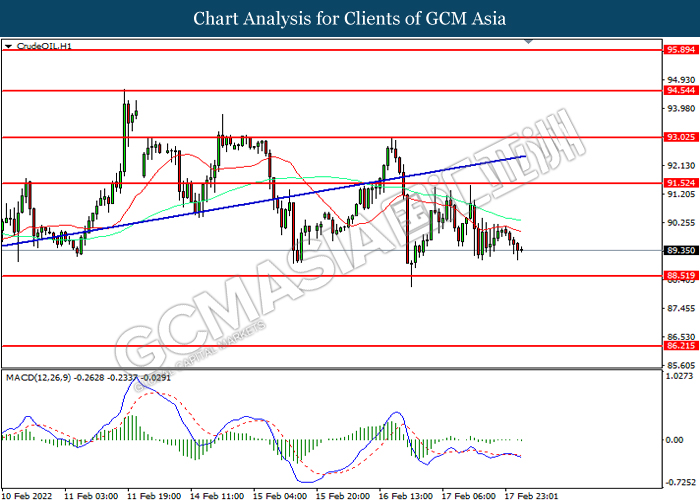

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 93.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 91.50

Resistance level: 93.05, 94.55

Support level: 91.50, 88.50

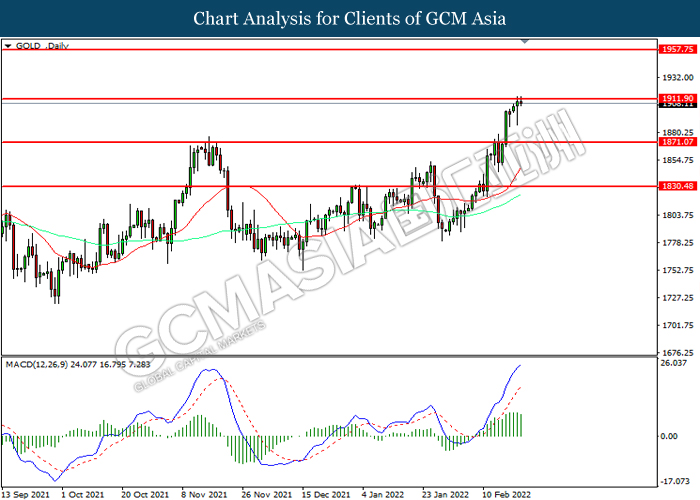

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1911.90. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1911.90, 1957.75

Support level: 1871.05, 1830.50

220222 Morning Session Analysis

22 February 2022 Morning Session Analysis

Russia declares separatist territories.

Greenback remains high in demand in the financial market as Russian and Ukraine tension rises since yesterday. According to reports, Russia President Vladimir Putin has signed a decree to recognize two separatist territories in Ukraine and declared their willingness for independence. The decree has sparked wide condemnation internationally, with US, UK and France calling the move as a violation to the international law. Following the incident, US stated that they will be sending in their troops to the separatist territories in the next few hours. Investors fear that a war may break out in between both countries as satellite images shows that Russian troops were moving into the two separatist territories. Recent move from Russia has also decrease the chances of a summit occurring in between US and Russia although US reiterates they are still open for discussion. As of writing, dollar index was up 0.01% to 95.91.

In the commodities market, crude oil price was down 0.48% to $92.32 per barrel due to technical correction from the higher levels. On the other hand, gold price was up 0.30% to $1,909.10 a troy ounce due to rising tension in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 95.7 | 96.5 | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 113.8 | 109.8 | – |

Technical Analysis

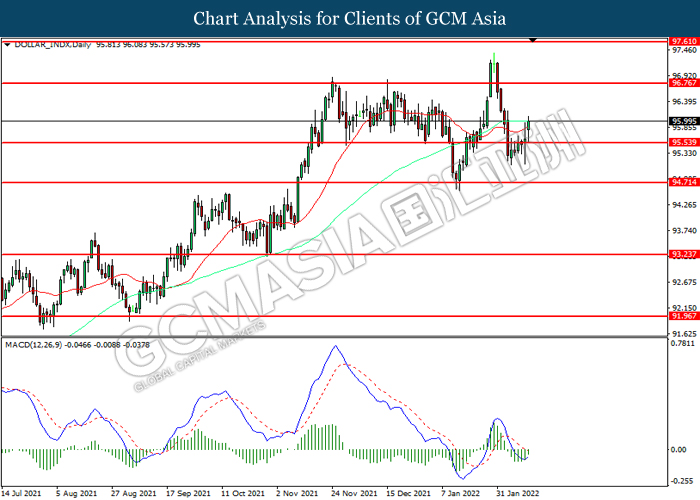

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1290, 1.1245

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7230, 0.7270

Support level: 0.7180, 0.7140

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10

210222 Afternoon Session Analysis

21 February 2022 Afternoon Session Analysis

Pound Sterling surged amid easing tensions between Ukraine-Russia.

The Pound Sterling received bullish momentum following the easing tensions between Ukraine and Russia, which spurring risk-on sentiment in the global financial market while prompting investors to shift their portfolio toward riskier currency such as Pound Sterling. According to Reuters, French leaders claimed that US President Joe Biden and Russian President Vladimir Putin have agreed in principle to a summit over Ukraine issues, discussing a possible path out of one of the most dangerous global crises in decades. Though, investors would continue to scrutinize the latest development with regards of such issues to receive further trading signal. Besides that, the Pound Sterling extend its gains over the backdrop of bullish economic data last week. According to Office for National Statistics, UK Retail Sales notched up from the previous reading of -4.0% to 1.9%, exceeding the market forecast at 1.0%. As of writing, GBP/USD appreciated by 0.22% to 1.3620.

In the commodities market, the crude oil price slumped 1.25% to $91.35 per barrel as of writing. The oil market edged lower following the easing tensions between Russia-Ukraine, which spurring the hopes upon the resolution of oil supply disruption in future. On the other hand, the gold price depreciated by 0.02% to $1898.30 per troy ounces as of writing amid risk-on sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – President’s Day

All Day CAD Canada – Family Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 59.8 | 59.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | – | – |

| 17:30 | GBP – Services PMI | 54.1 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 95.95. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3505. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3615, 1.3730

Support level: 1.3505, 1.3440

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1380. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 115.40. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 114.30.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7205. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2780. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.2655.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9175. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 91.50. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 88.50.

Resistance level: 91.50, 93.05

Support level: 88.50, 86.20

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1900.35. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1900.35, 1923.35

Support level: 1870.15, 1847.60

210222 Morning Session Analysis

21 February 2022 Morning Session Analysis

Greenback rises as war imminent.

Investors shifted their focus from risky assets to safe-havens such as US dollar following rising tension in between Russia and Ukraine. According to CBS News, US intelligence has received information that Russian commander received directive to invade Ukraine. Moreover, they are currently planning strategies to carry out the attack which may happen in the near future. Although Moscow has denied such allegations, US emphasized that recent military exercise near the borders shows their preparedness to carry out the invasion. As of writing, more than 30,000 Russian troops have amassed near the Ukrainian border. At the same time, it is reported that US Secretary Antony Blinken is scheduled to meet Russia’s Foreign Minister Sergei Lavrov within this week for further discussion. During Asian trading session, the dollar index was up 0.02% to 96.05.

As for commodities, crude oil price skyrocketed 1.32% to $91.57 per barrel over rising tension in between Russia and Ukraine. Likewise, gold price rose 0.45% to $1,905.04 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – President’s Day

All Day CAD Canada – Family Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 59.8 | 59.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | – | – |

| 17:30 | GBP – Services PMI | 54.1 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10

180222 Afternoon Session Analysis

18 February 2022 Afternoon Session Analysis

Australia Dollar surged amid resilient job market.

The Australia Dollar surged over the backdrop of bullish economic data yesterday, which spurring bullish momentum on the pair of AUD/USD. According to Australian Bureau of Statistics, Australia Employment Change came in at 12.9K, exceeding the market forecast at -15.0K. As the data had fared better than expectation, which dialled up market optimism toward the economic progression in Australia while increasing hawkish expectation from Reserve Bank of Australia in future. Though, the gains experienced by the Australia Dollar was limited by the risk-off sentiment tin the global financial market. Recently, the rising geopolitical tensions between Russia dan Ukraine had continued to stoke a shift in sentiment toward safe-haven asset, diminishing demand for Australia Dollar. As for now, investors would continue to scrutinize the latest updates with regards of the geopolitical tensions between Ukraine and Russia as well as further economic data to receive further trading signal. As of writing, AUD/USD appreciated by 0.22% to 0.7200.

In the commodities market, the crude oil price depreciated by 0.76% to $91.25 per barrel as of writing. The oil market edged lower amid market participants speculated that the positive prospect of US-Iran nuclear dear would induce United States to remove the trade tariff from Iran, which increasing the oil supply in future. On the other hand, the gold price depreciated by 0.40% to $1891.00 per troy ounces as of writing amid technical correction.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jan) | -3.7% | 1.0% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 1.1% | -2.0% | – |

| 23:00 | USD – Existing Home Sales (Jan) | 6.18M | 6.10M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 95.95. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3505. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3615, 1.3730

Support level: 1.3505, 1.3440

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1380. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded higher while currently near the resistance level at 115.40. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7205. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2655. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9175. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H1: Crude oil price was traded lower while currently near the support level at 88.50. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 91.50, 93.05

Support level: 88.50, 86.20

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1900.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1900.35, 1923.35

Support level: 1870.15, 1847.60

180222 Morning Session Analysis

18 February 2022 Morning Session Analysis

Russia and Ukraine on the brink of war.

Greenback oscillates within a small range as market participants digests mixed signals in the financial market. Earlier yesterday, US dollar received some substantial selloff following the release of bearish economic data. For the month of February, Philadelphia Fed Manufacturing Index slumped to 16.0, lower than forecast of 20.0. Likewise, Initial Jobless Claims ticks up to 248K as ongoing infections of Omicron variant in the US ravage through the employment market. Nonetheless, losses on the greenback is rather limited as tensions in between Russia and Ukraine rises. Latest report shows that Russia has sent back US’s diplomat from its Moscow embassy. The move came after US rejected Russia’s request of national security as US and NATO troops amasses near the Russian border. US also reemphasize that Ukraine is still vulnerable as Russia may attack at any point of time. As of writing, the dollar index was down 0.01% to 95.77.

For commodities, crude oil price was up 0.10% to $89.93 per barrel due to growing tension in between Russia and Ukraine. Likewise, recent tension has also pushed gold price higher, up by 0.05% to $1,899.40 a troy ounce.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jan) | -3.7% | 1.0% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 1.1% | -2.0% | – |

| 23:00 | USD – Existing Home Sales (Jan) | 6.18M | 6.10M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2600

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 91.00, 93.15

Support level: 88.95, 86.95

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10

170222 Afternoon Session Analysis

17 February 2022 Afternoon Session Analysis

UK consumer faces cost of living crisis.

Pound sterling charges ahead from lower level as inflation pressure in the UK mounts. The latest figure from UK Office for National Statistics showed that Consumer Price Index rose 0.1% to 5.5% in January, its highest level since 1992. Last month’s inflation was mainly contributed by rising prices of clothing and footwear while other items such as electricity and food were also in the mix. Economists warned that recent jump in cost of living may appreciate further, peaking at 8% by April as household energy bills soars sharply. Although UK government introduced measures to ease rising household energy bills, economists cautioned that such measure could cost the government an extra £11 billion this year. Nevertheless, investors reacted positively towards the data as it may force Bank of England to take aggressive measures such as numerous interest rate hikes in order to curb rising inflation. As of writing, pair of GBP/USD was up 0.03% to 1.3590.

As for commodities, crude oil price was up by 0.79% to $89.65 per barrel following technical correction from lower levels. On the other hand, gold price was down 0.18% to $1,869.24 a troy ounce due to stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Jan) | 223K | 220K | – |

| 21:30 | USD – Initial Jobless Claims | 23.2 | 20 | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | 64.8K | -15.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. However, MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2600

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9230, 0.9255

Support level: 0.9210, 0.9190

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after breaking the support level.

Resistance level: 91.00, 93.15

Support level: 88.95, 86.95

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20

170222 Morning Session Analysis

17 February 2022 Morning Session Analysis

Lack of hawkishness in Fed minutes.

Investors began to reassess their sentiment towards the US dollar following a more dovish meeting minutes from the Federal Reserve. Within the minutes, Fed officials reemphasized that US inflation which lingers at its highest since 1982 may pose a threat towards the economy and jobs market. They also emphasized that keeping monetary policy loose at a longer period of time may jeopardize overall economic momentum. Thus, Fed suggested that they will initiate an interest rate hike which is currently speculated to be done on March meeting. However, Fed reiterates that the decision to initiate a rate hike depends on their analysis of current economic situation which will be done on a meeting basis. The signal suggests that Federal Reserve will still require justification from future economic data, contradicts with market speculation that they will tighten the monetary policy at a faster pace. As of writing, the dollar index is down by 0.01% to 95.75.

For commodities, crude oil price was down by 0.38% to $89.33 per barrel following possibility of US and Iran in reaching a denuclearization deal. On the other hand, gold price was up 0.01% to $1,869.40 a troy ounce due to weaker US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Jan) | 223K | 220K | – |

| 21:30 | USD – Initial Jobless Claims | 23.2 | 20 | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | 64.8K | -15.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. However, MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2600

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9230, 0.9255

Support level: 0.9210, 0.9190

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after breaking the support level.

Resistance level: 91.00, 93.15

Support level: 88.95, 86.95

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20

160222 Afternoon Session Analysis

16 February 2022 Afternoon Session Analysis

Pound rallied on upbeat economic data.

The Pound Sterling surged over the backdrop of upbeat economic data yesterday, which dialled up the market optimism toward the economic progression in United Kingdom. According to Office for National Statistics, UK Average Earning Index + Bonus notched up significantly from the previous reading of 4.2% to 4.3%, exceeding the market forecast at 3.8%. Meanwhile, UK Claimant Count Change came in at -31.9K, which also fared better than market expectation at -28.8K. The expected pay rise comes amid persistent signs of tight labour market, combined with face pace of economic recovery following the Covid-19 lockdowns at the start of the pandemic 2020. Besides, easing fears upon the Russian invasion of the Ukraine had stoked a shift in sentiment toward riskier asset, which spurring bullish momentum on the Pound Sterling. As of writing, GBP/USD appreciated by 0.06% to 1.3540.

In the commodities market, the crude oil price slumped 0.28% to 92.00 per barrel as of writing. The oil market edged lower following bearish inventory data was released. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at -1.076M, missing the market forecast at -1.769M. On the other hand, the gold price depreciated by 0.05% to $1852.20 per troy ounces as of writing amid risk-on sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Jan) | 5.40% | 5.40% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Jan) | -2.30% | 0.80% | – |

| 21:30 | USD – Retail Sales (MoM) (Jan) | -1.90% | 1.80% | – |

| 21:30 | CAD – Core CPI (MoM) (Jan) | 0.00% | 0.00% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -4.756M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 95.95. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level at 96.80.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3505. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3595.

Resistance level: 1.3595, 1.3715

Support level: 1.3505, 1.3450

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1380.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 115.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 116.25.

Resistance level: 116.25, 117.50

Support level: 115.40, 114.30

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7205

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6710. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6535.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2625. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9270. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 91.20. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 91.20, 93.05

Support level: 88.50, 86.20

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1870.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1847.60.

Resistance level: 1870.15, 1900.35

Support level: 1847.60, 1828.00

160222 Morning Session Analysis

16 February 2022 Morning Session Analysis

Peaceful world ahead?

Greenback reverses its course and stages a substantial correction on yesterday after tensions in between Russia and Ukraine begins to subside. According to reports, US satellite image shows that Russia has recalled a portion of their troops from Ukraine borders. Russia President’s Office also confirmed the recall, showing Kremlin’s approach to dial down both parties’ tension which could open up to diplomatic talks in between both countries. However, US counterpart warned that Russia may stage an attack at any point of time as 60% of their troops still remains near the border. Nonetheless, US dollar’s losses were limited following substantial increase in PPI. Last month, PPI rose 1.0%, its largest increase in 8 months amid surge in cost of hospital outpatient care and goods such as food. The data has reinforced Federal Reserve’s view to tighten monetary policy at a faster pace to curb rising inflation in the US. As of writing, dollar index was up 0.01% to 95.92.

For commodities, crude oil price rose 0.29% to $90.48 per barrel. Oil prices were traded lower on yesterday following diminishing tension in between Russia and Ukraine. On the other hand, gold price was down by 0.01% to $1,853.05 a troy ounce due to lower geopolitical risk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Jan) | 5.40% | 5.40% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Jan) | -2.30% | 0.80% | – |

| 21:30 | USD – Retail Sales (MoM) (Jan) | -1.90% | 1.80% | – |

| 21:30 | CAD – Core CPI (MoM) (Jan) | 0.00% | 0.00% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -4.756M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. However, MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after breaking the support level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20

150222 Afternoon Session Analysis

15 February 2022 Afternoon Session Analysis

Risk-off sentiment spurred demand on safe-haven Yen.

USDJPY extended its losses as tensions between Russia and Ukraine are increasing. As Ukraine President Volodymyr Zelensky stated that Russia would attack his country on February 16, investors are heading towards Japanese Yen as one of the safe haven assets aside commodities. Besides that, the data of Japan’s Preliminary Gross Domestic Product (GDP) for the fourth quarter rose 1.3% versus 1.4% expected and -0.9% prior. Further, GDP Annualized also rose 5.4% as compared to -3.6% prior, below forecast of 5.8%. Despite being lower than expected data, the positive data has helped the pair to limit its losses. For the time being, investors will continue to monitor crucial updates from the Russia-Ukraine tensions as well as other news event from Japan in order to gauge the movement of the pair. As of writing, the USDJPY was down 0.21% to 115.364.

In the commodities market, crude oil price was down 0.45% to $92.82 per barrel after price has reached a higher level of resistance. On the other hand, gold price was up 0.27% to $1876.94 per troy ounce due to Russia and Ukraine tensions.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 4.20% | 3.90% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | -43.3K | -36.2K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 51.7 | 53.5 | – |

| 21:30 | USD – PPI (MoM) (Jan) | 0.30% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 95.95. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level at 96.80.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3505. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3595.

Resistance level: 1.3595, 1.3715

Support level: 1.3505, 1.3450

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1290. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 115.40. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 116.25, 117.50

Support level: 115.40, 114.30

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7125. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7125, 0.7205

Support level: 0.7055, 0.7000

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6710. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6535.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 93.05. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 93.05, 94.55

Support level: 91.10, 88.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1871.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1900.35.

Resistance level: 1900.35, 1923.35

Support level: 1871.30, 1847.60

150222 Morning Session Analysis

15 February 2022 Morning Session Analysis

Fed geared up to hike rates.

US dollar receives higher demand as Federal Reserve continuously deliver hawkish tone towards the financial market. According to an interview with CNBC, Fed member James Bullard emphasized that current inflationary pressure in the US is still high and it warrants for more drastic measures to be taken. Bullard suggests that they will need to hike interest rates at least 100 basis points before July in order to prevent the economy from overheating. In summary, majority of Fed officials has revealed their willingness to support for an interest rate hike starting March while several of them supports for the idea to have an interest rate hike at least 25 basis points. For the time being, investors will continue to place their attention upon upcoming signals from the US in order to gauge US dollar’s trend direction. As of writing, the dollar index was up 0.01% to 96.20.

In the commodities market, crude oil price was down by 0.34% to $92.81 per barrel following technical correction from its higher levels. On the other hand, gold price was up 0.01% to $1,870.87 a troy ounce due to escalating tension in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 4.20% | 3.90% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | -43.3K | -36.2K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 51.7 | 53.5 | – |

| 21:30 | USD – PPI (MoM) (Jan) | 0.30% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. However, MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20

140222 Afternoon Session Analysis

14 February 2022 Afternoon Session Analysis

Doves flutters, Euro nosedive.

Euro extended its losses during Asian trading session as European Central Bank delivers more dovish signals as of recent. Last weekend, European Central Bank’s member Olli Rehn, he warned that overreaction to inflation from central bank may jeopardize overall economic growth. He commented that it is recommended to look beyond short-term inflation spikes and project inflationary trend for 2023 and 2024. Rehn also stated that European Central Bank has ample amount of time to decide in March and later meetings if the economy progresses differently as compared to current situation. While ECB emphasize to continue to expansionary monetary policy, Rehn suggests that gradual tightening will be done at a consistent pace with economic recovery and progress. As of writing, EUR/USD was down by 0.03% to 1.1340.

In the commodities market, crude oil price rose 0.86% to $93.00 per barrel as Russia-Ukraine tensions sparks speculation over disruption in oil supply from the region. On the other hand, gold price ticked down 0.41% to $1,853.75 a troy ounce due to technical correction.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20

140222 Morning Session Analysis

14 February 2022 Morning Session Analysis

Rising tensions between Russia-Ukraine, spurring bullish momentum on safe-haven Dollar.

The Dollar Index which traded against a basket of six major currency surged following the rising tensions between Russia and Ukraine, which stoked a shift in sentiment toward the safe-haven US Dollar. The United States claimed on Sunday that Russia could invade Ukraine at any time and would create a surprise pretext for an attack. According to Reuters, currently Russia has more than 100,000 troops massed around Ukraine, which increasing further tensions between of both countries. President Biden spoke with Vladimir Putin yesterday and warned that the US and its allies will response “decisively and impose swift and severe costs” on Russia if Putin decide to invade Ukraine. Market participants speculated that such rising geopolitical tensions between both countries would likely to be jeopardizing the global economic, which increasing the appeal for safe-haven asset. As of writing, the Dollar Index appreciated by 0.10% to 96.10.

In the commodities market, the crude oil price surged 0.04% to $94.15 per barrel as of writing following the escalating fears of an invasion of Ukraine by Russia, added further concerns over the global supply disruption for crude oil. As for now, investors would continue to focus on the development with regards of the tensions between Russia-Ukraine to gauge the likelihood movement for this black-commodity. On the other hand, the gold price appreciated by 0.15% to $1861.40 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 96.75, 97.60

Support level: 95.55, 94.70

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.3615, 1.3655

Support level: 1.3510, 1.3445

EURUSD, Daily: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1455, 1.1530

Support level: 1.1340, 1.1195

USDJPY, H4: USDJPY was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 116.20, 117.0

Support level: 115.40, 114.50

AUDUSD, Daily: AUDUSD was traded lower following retracement from higher level. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.7270, 0.7455

Support level: 0.7115, 0.7000

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.6690, 0.6830

Support level: 0.6530, 0.6385

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to extend gains after it successfully breakout the resistance level.

Resistance level: 1.2755, 1.2825

Support level: 1.2660, 1.2580

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9215. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9305, 0.9375

Support level: 0.9215, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded in short-term.

Resistance level: 92.40, 94.60

Support level: 88.75, 85.90

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1850.50. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1873.30.

Resistance level: 1873.30, 1896.50

Support level: 1850.50, 1829.65