110222 Afternoon Session Analysis

11 February 2022 Afternoon Session Analysis

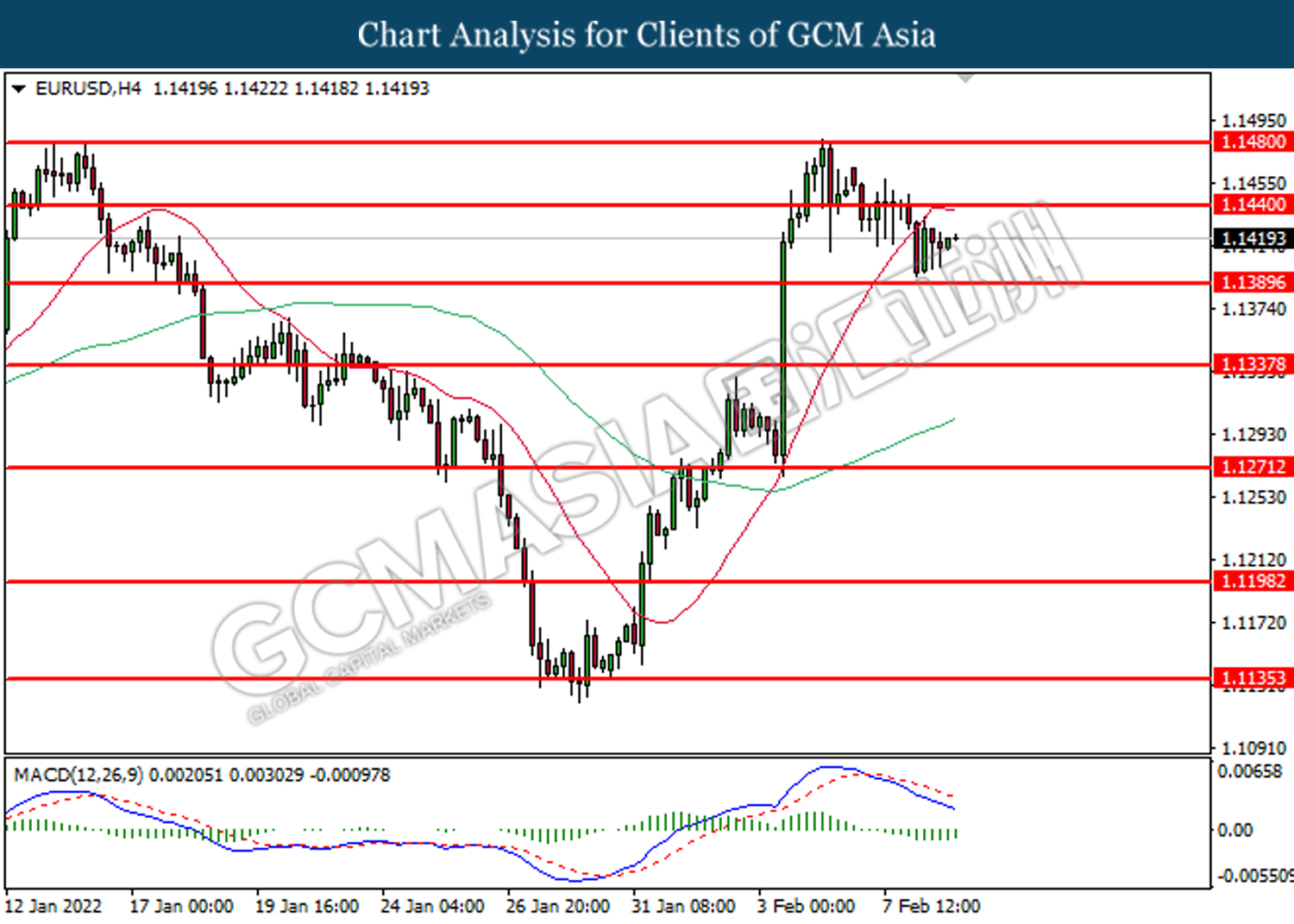

EURUSD slips as dollar strengthens.

Euro suffered losses after a spike due to possible rate hike from US Consumer Price Index data released yesterday. That said, the US Consumer Price Index (CPI) and comments from various Fed speakers weighed on the pair prior to European Central Bank (ECB) President Christine Lagarde’s statements. According to reports, US CPI data for January rallied to a nearly five-decade high with a 7.5%, versus 7.3% expected and 7.0% prior. However, the latest comments from Fed Richmond President Thomas Barkin seemed to help the major currency pair in trimming intraday losses to 0.30%. Although the hot inflation figures were already expected, St. Louis Fed President James Bullard went a step farther while supporting 100 bps rate hikes by July and for the balance sheet reduction to start in the second quarter, Fed’s Bullard also cited the potential for 50 basis points (bps) of Fed rate hike in March, hence brought the pair lower. Nonetheless, investors will continue to scrutinize updates from the US to gauge the movement of the pair. As of writing, EURUSD dropped by 0.42% to 1.1383.

In the commodities market, crude oil down 0.41% to $88.60 per barrel due to optimism grows in the progress of Iranian nuclear talks. On the other hand, gold price was down 0.18% to 1823.72 per troy ounce due to US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GDP (YoY) (Q4) | 6.80% | 6.50% | – |

| 15:00 | Manufacturing Production (MoM) (Dec) | 1.10% | 0.20% | – |

Technical Analysis

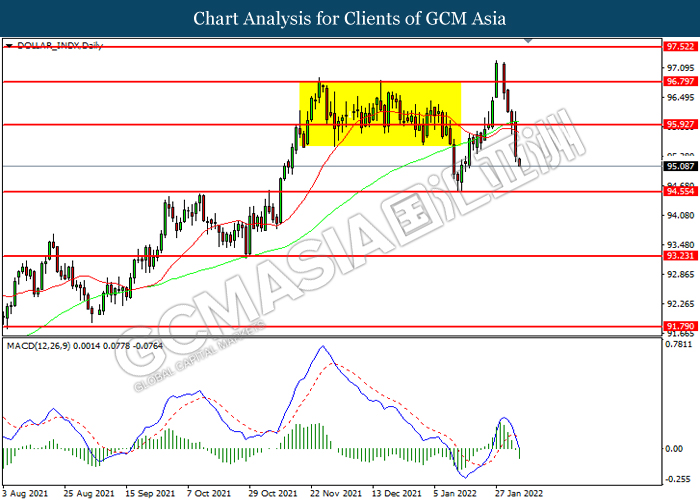

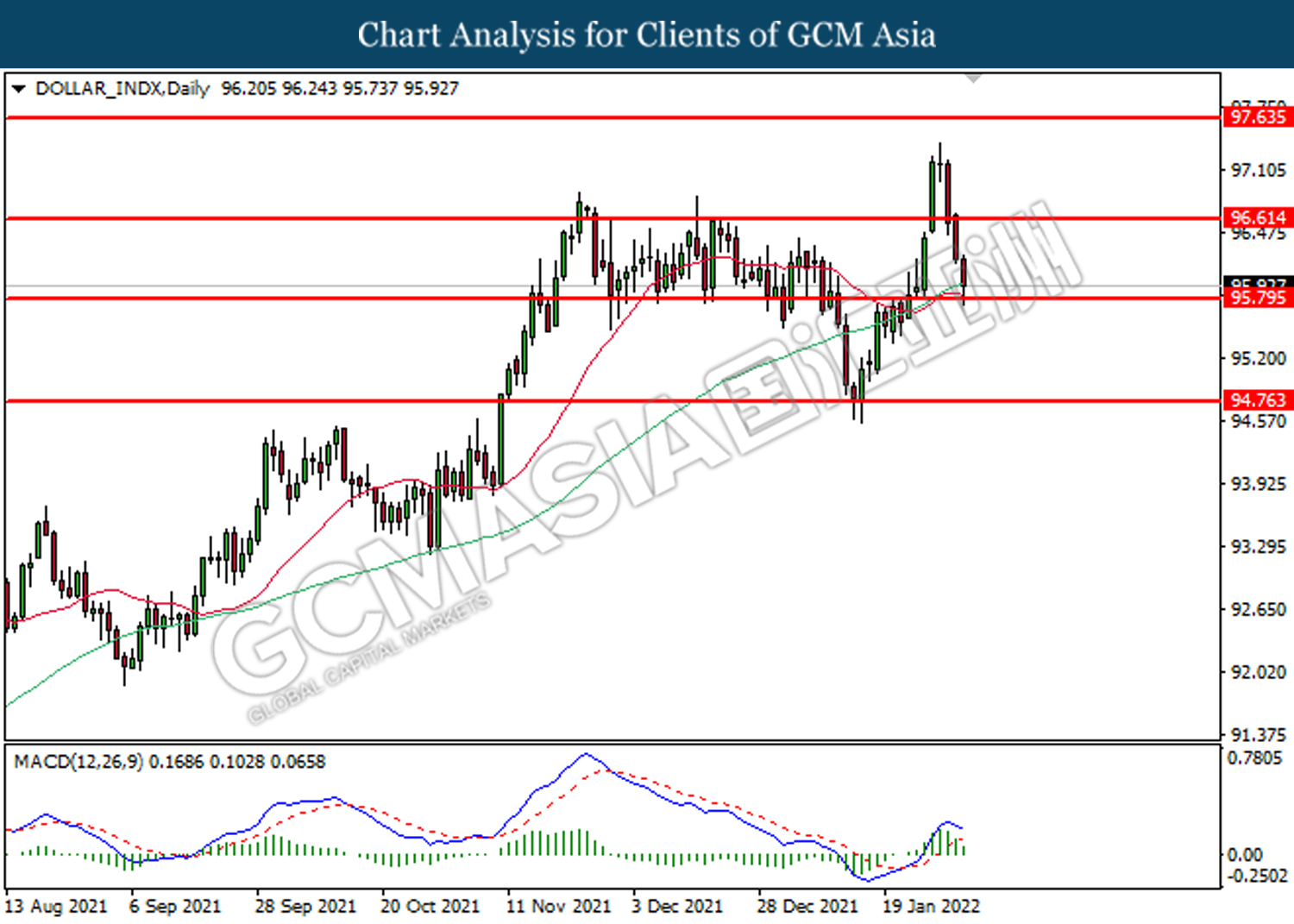

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.95. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

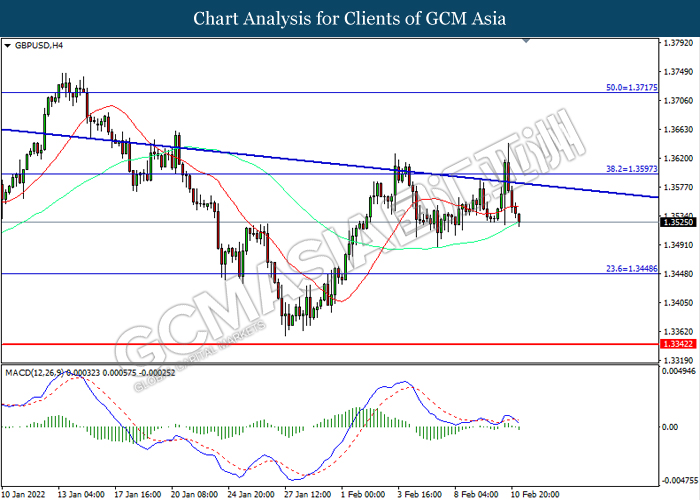

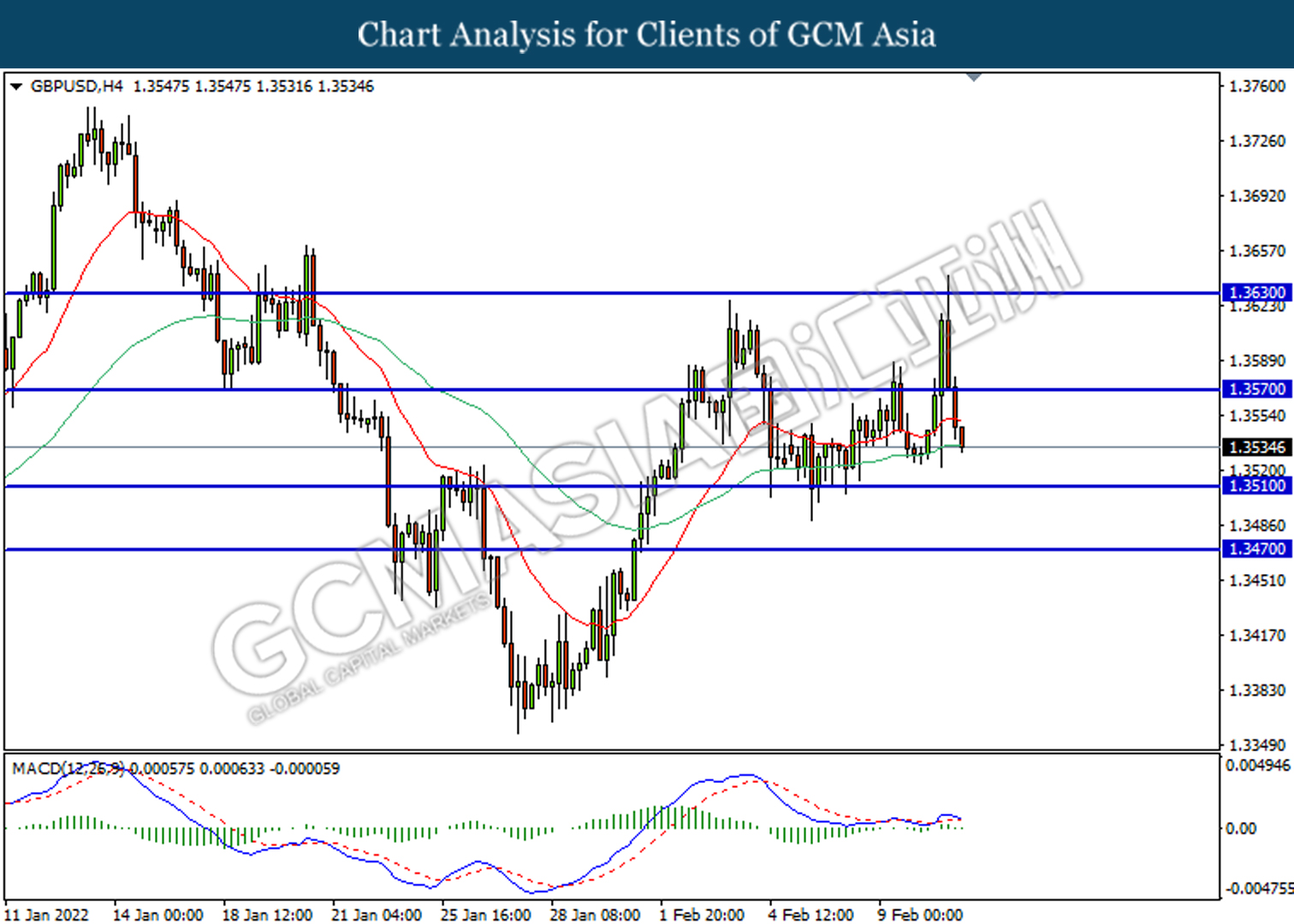

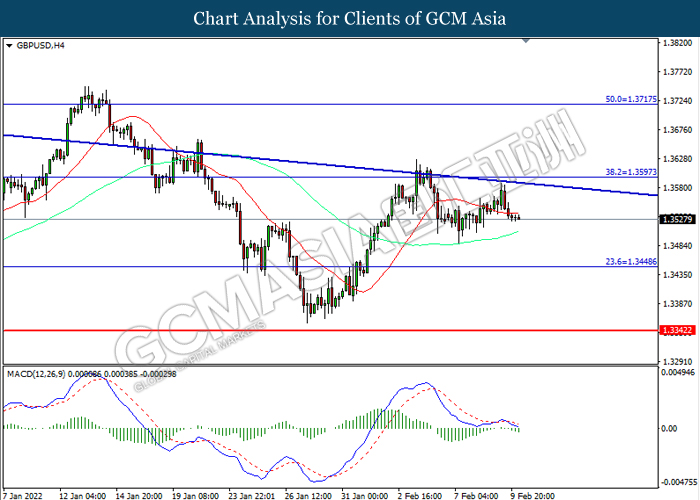

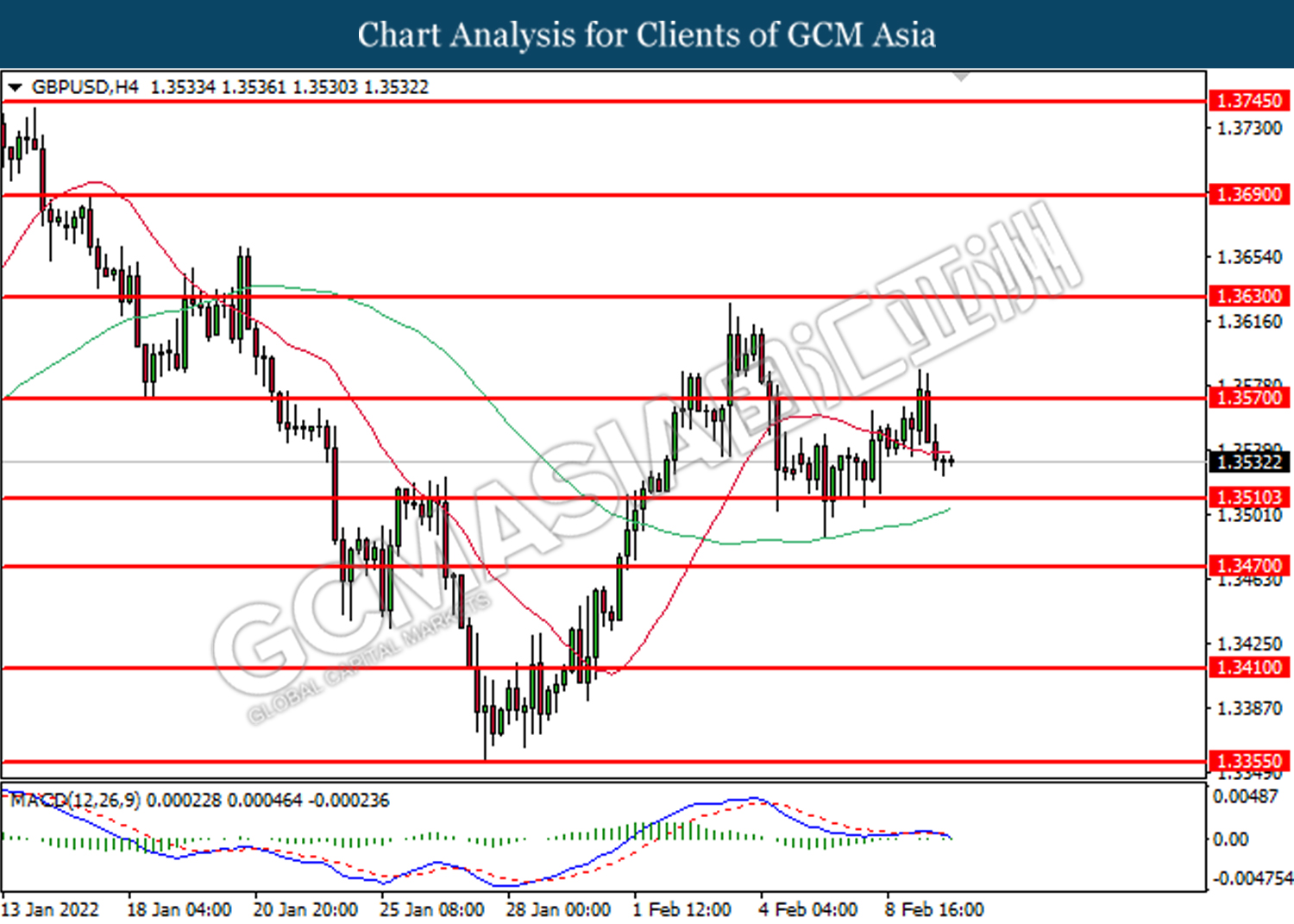

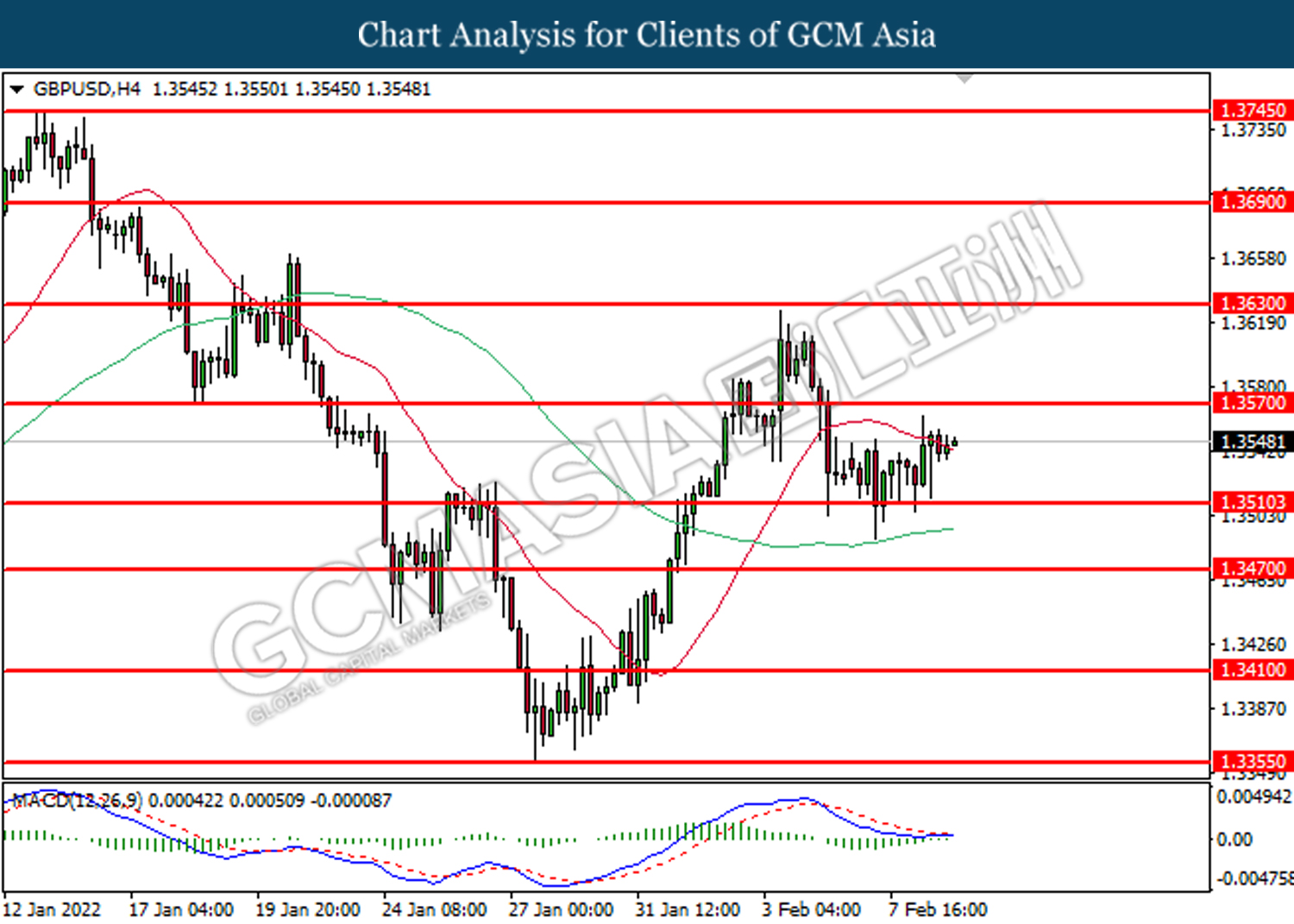

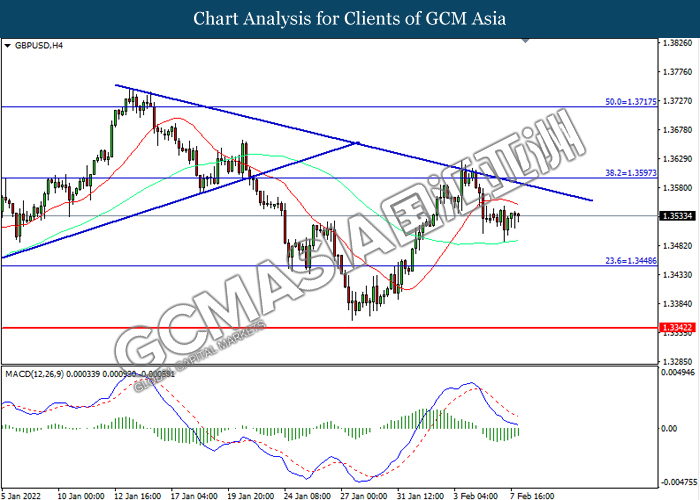

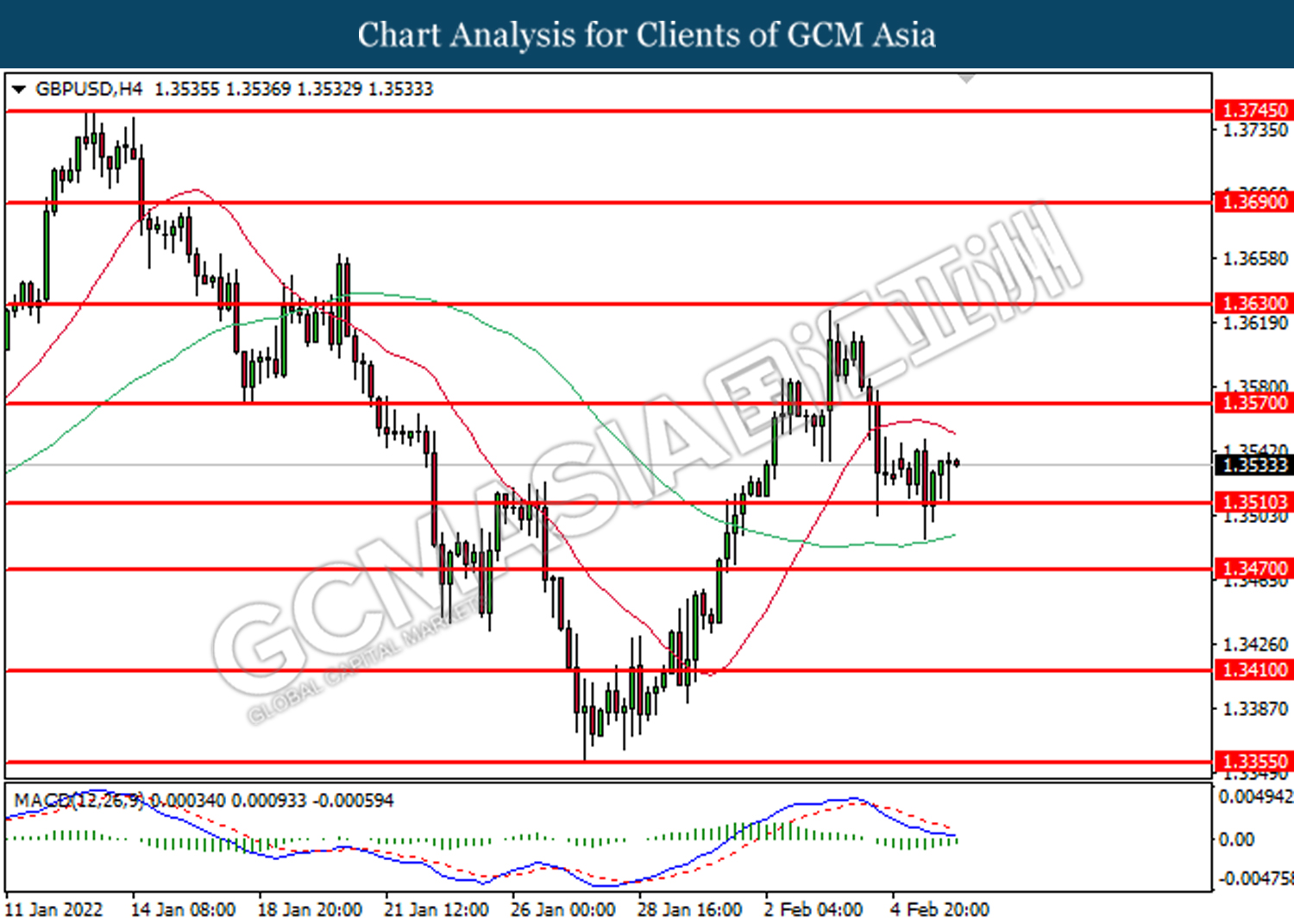

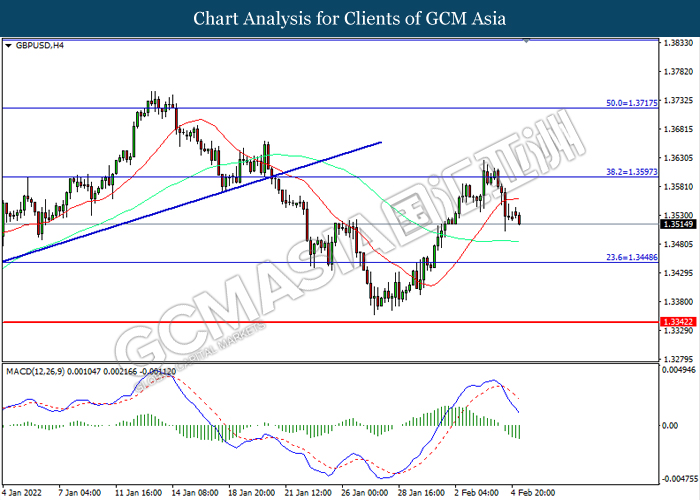

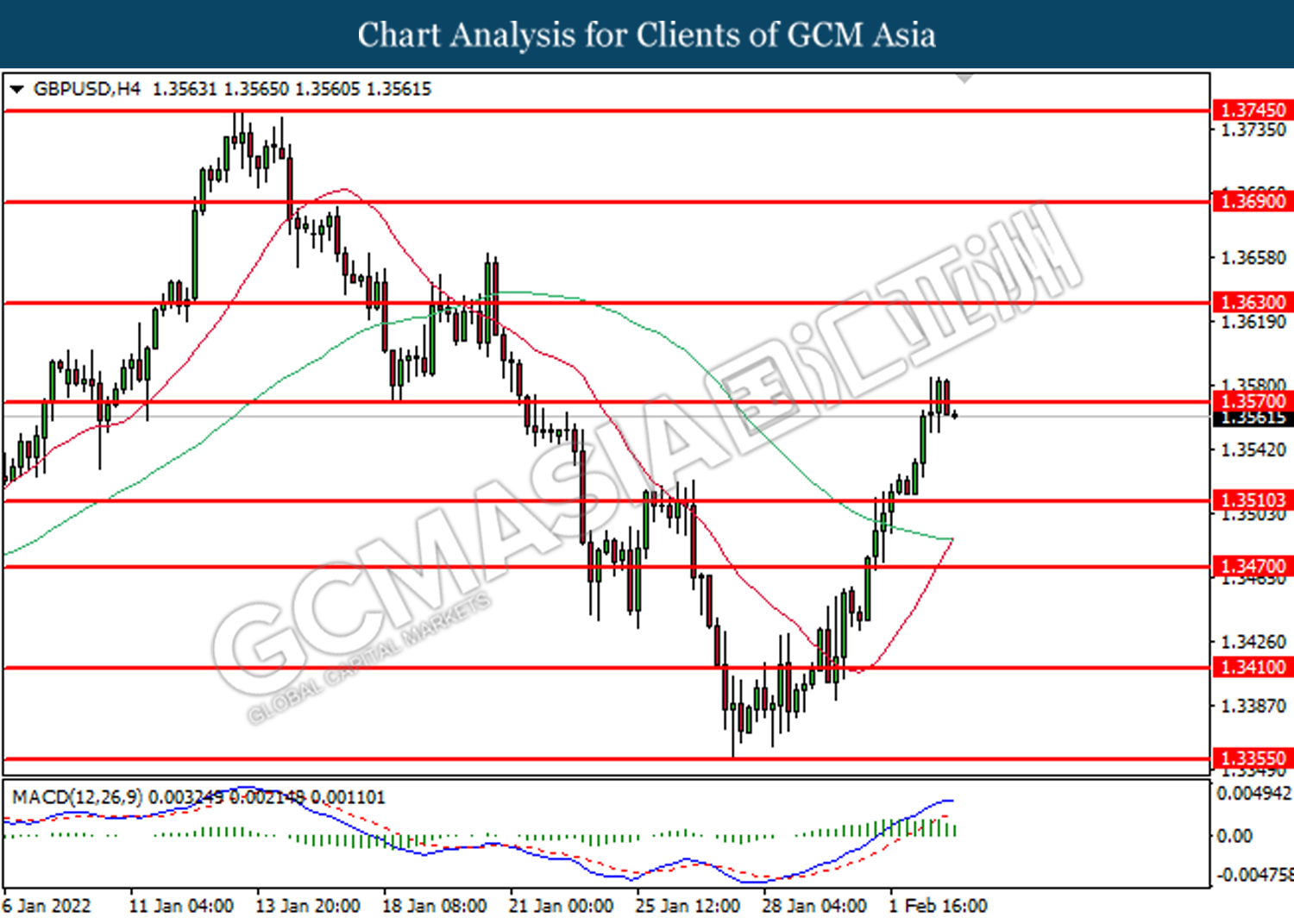

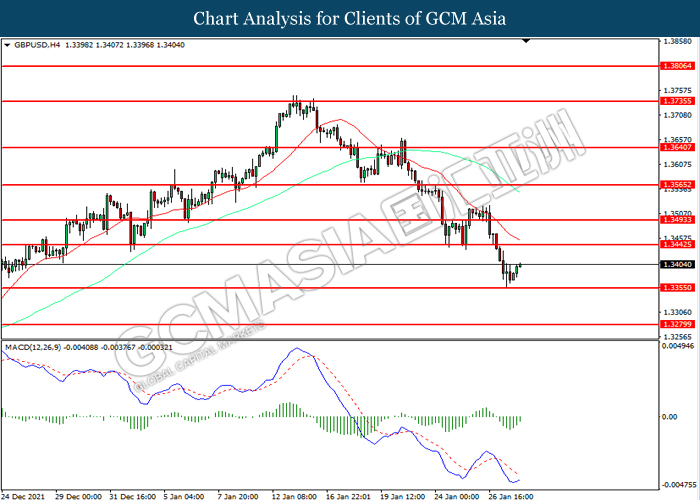

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

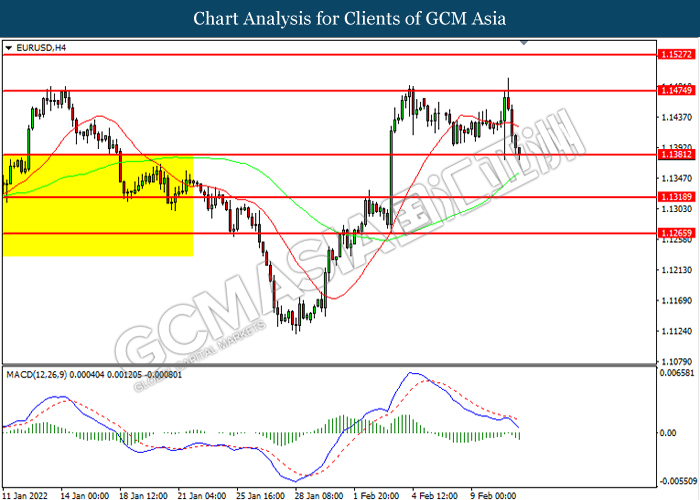

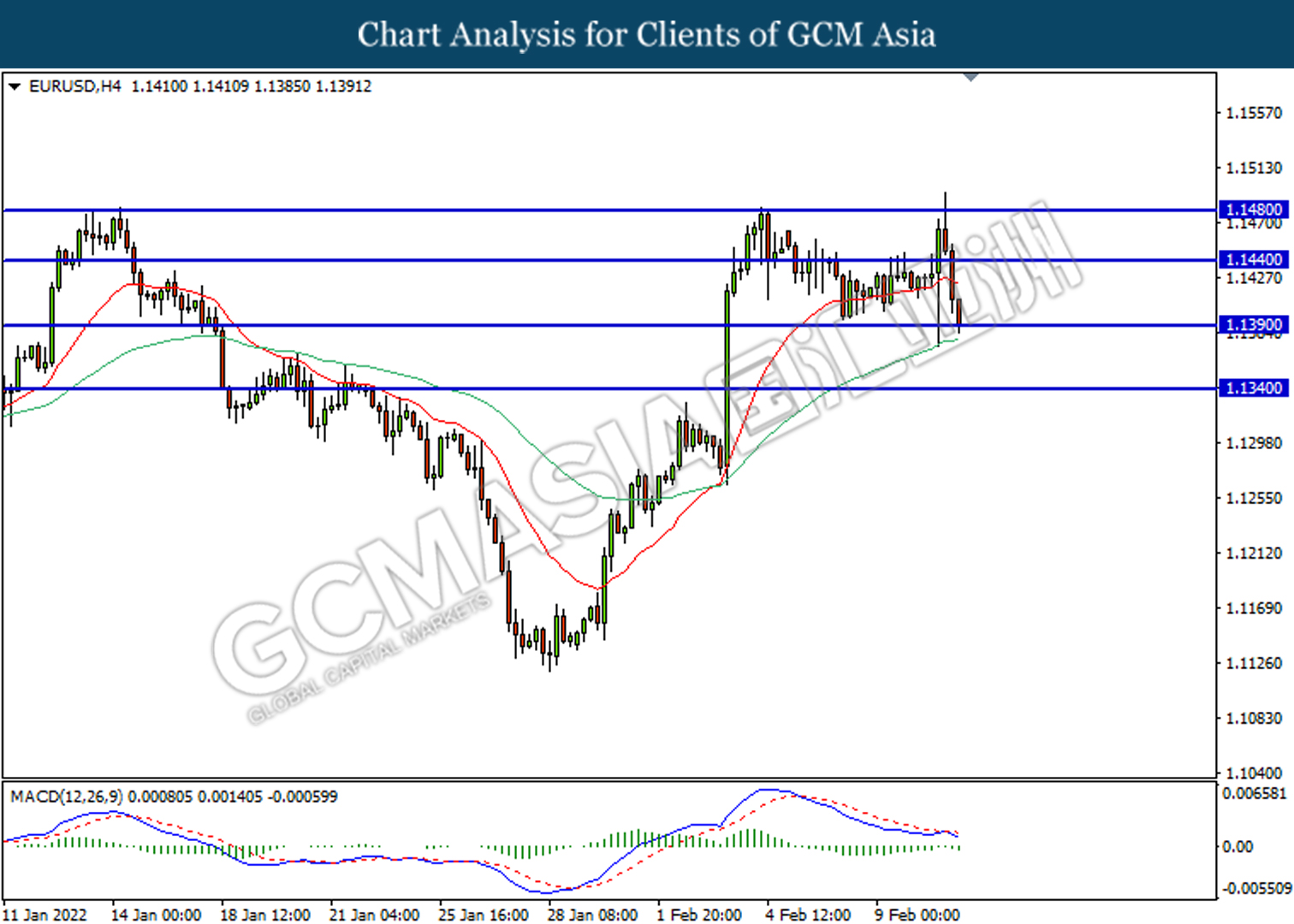

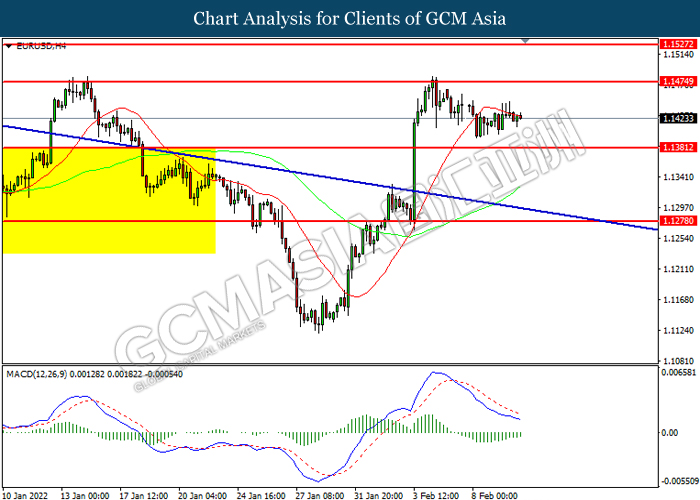

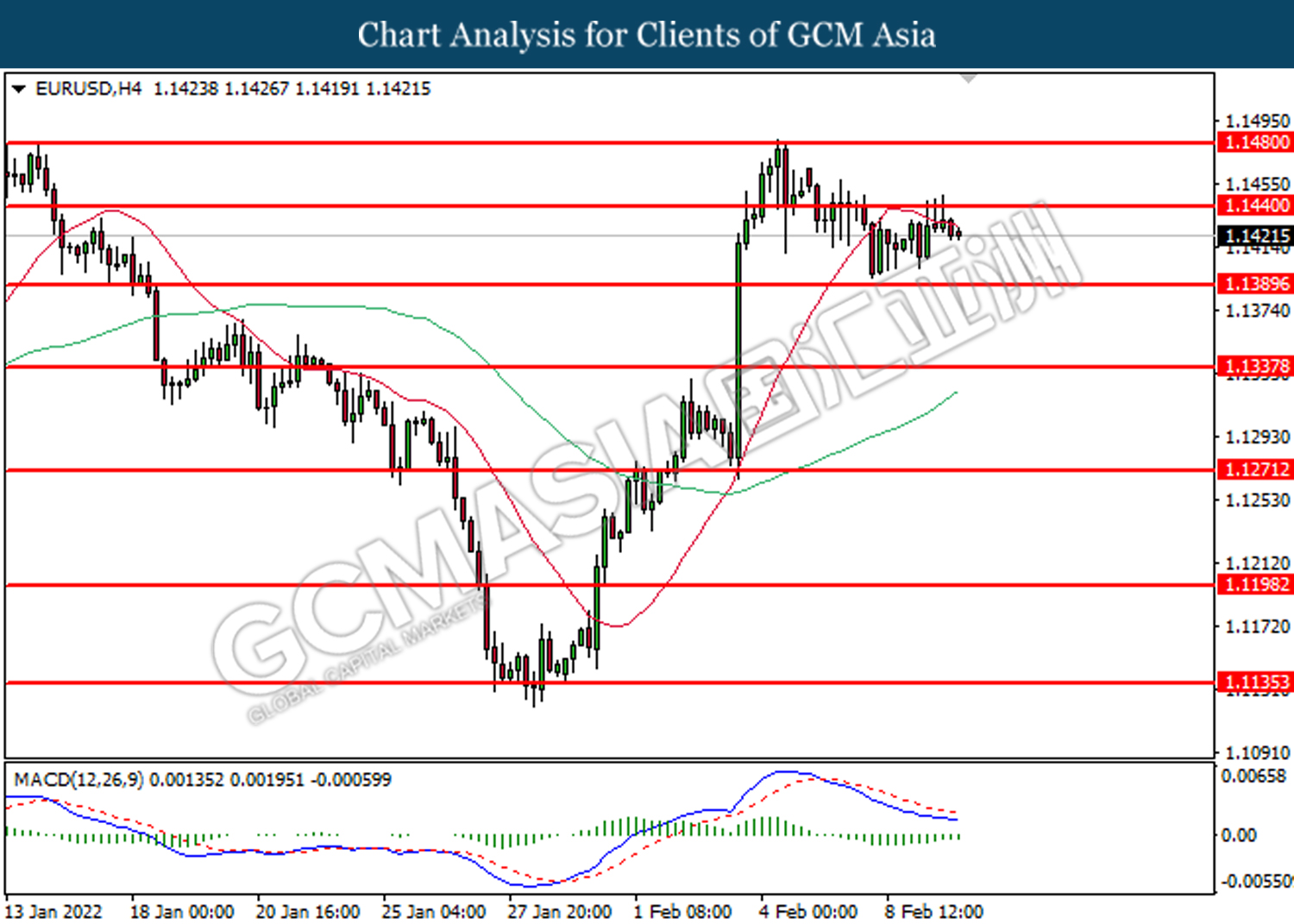

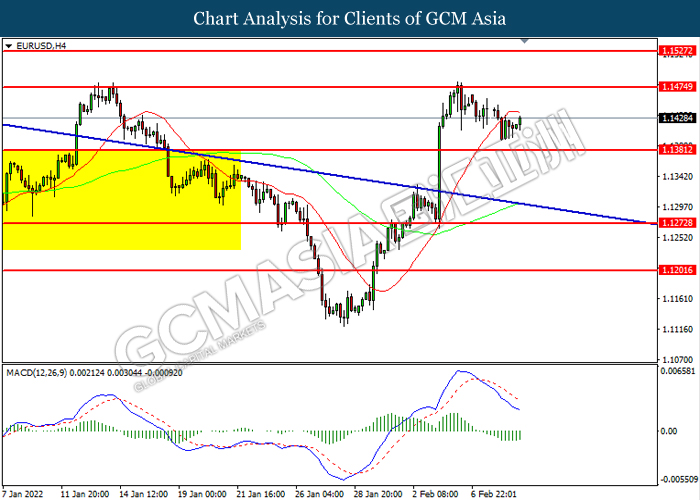

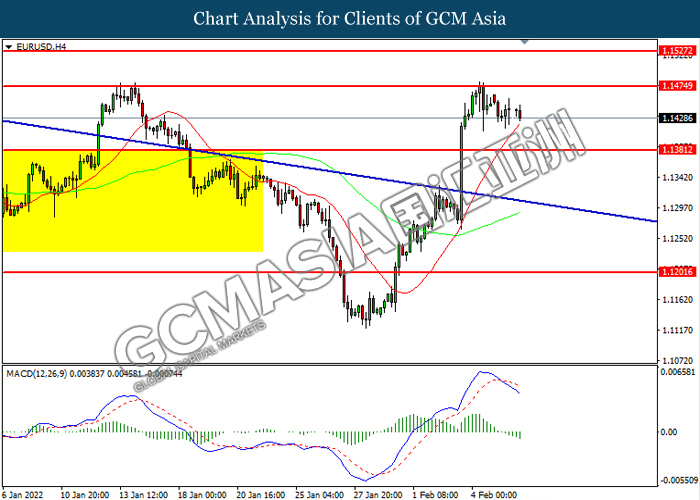

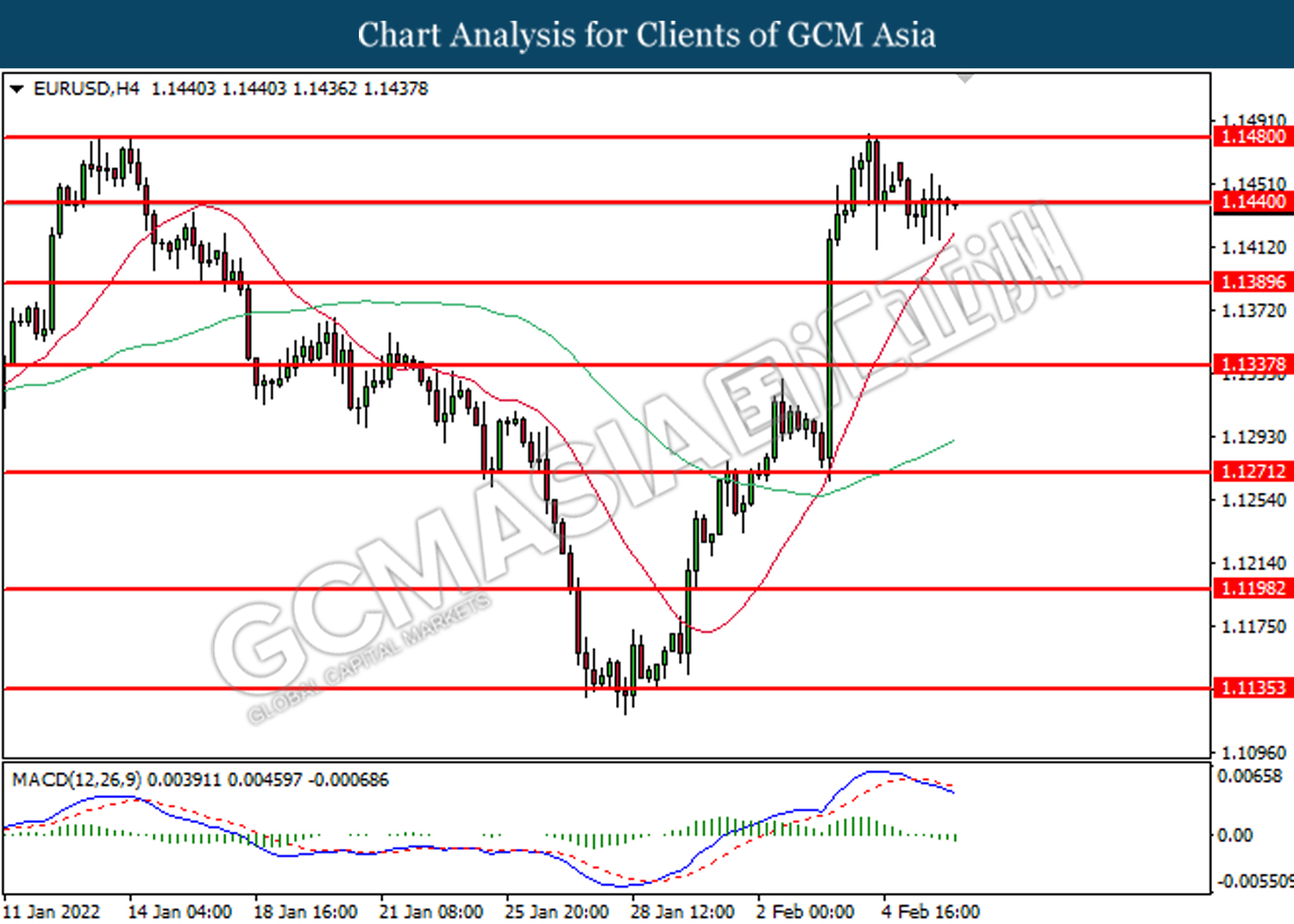

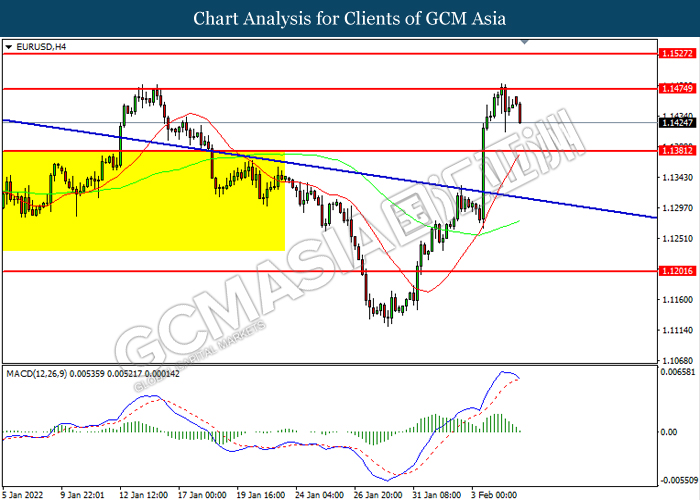

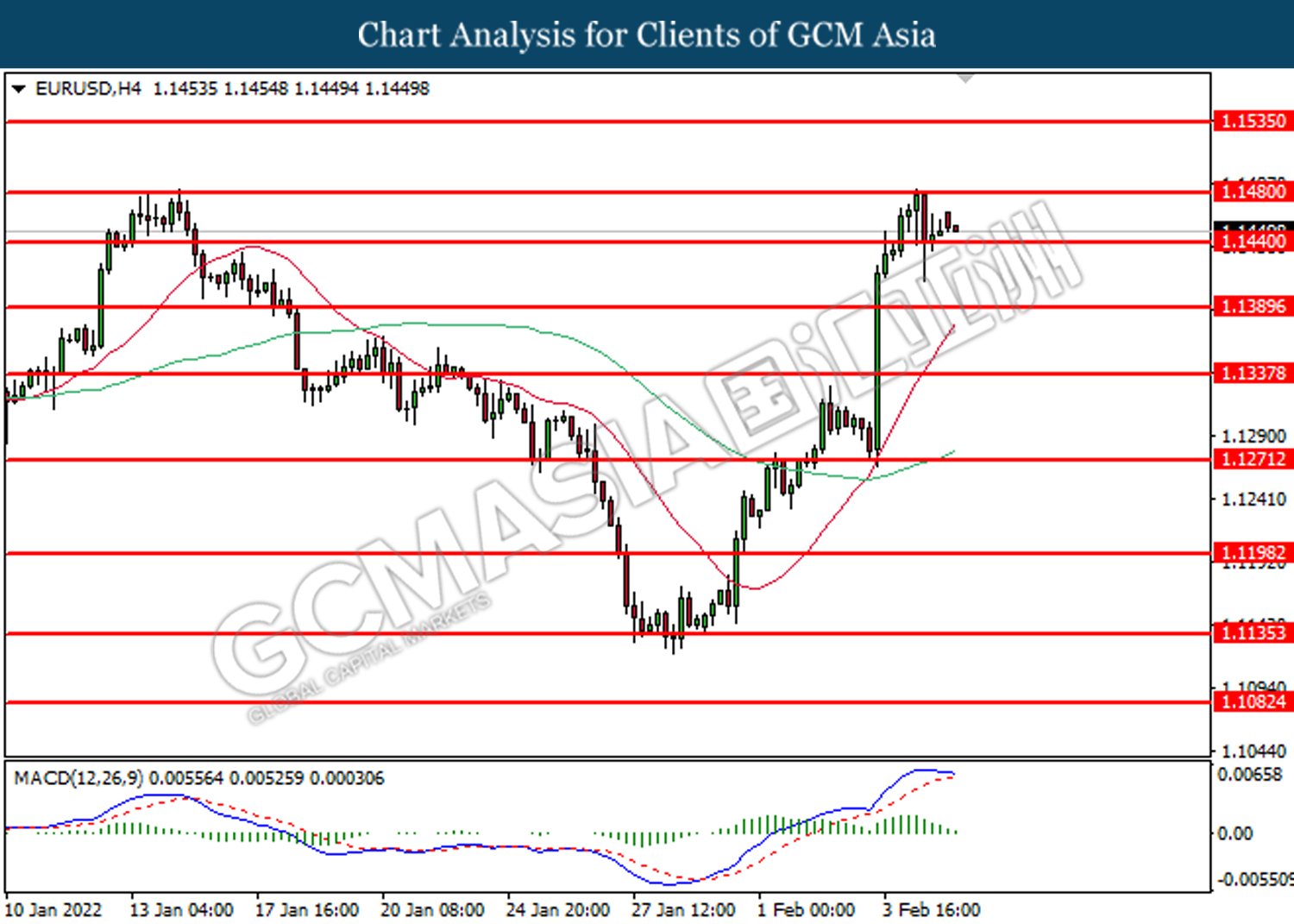

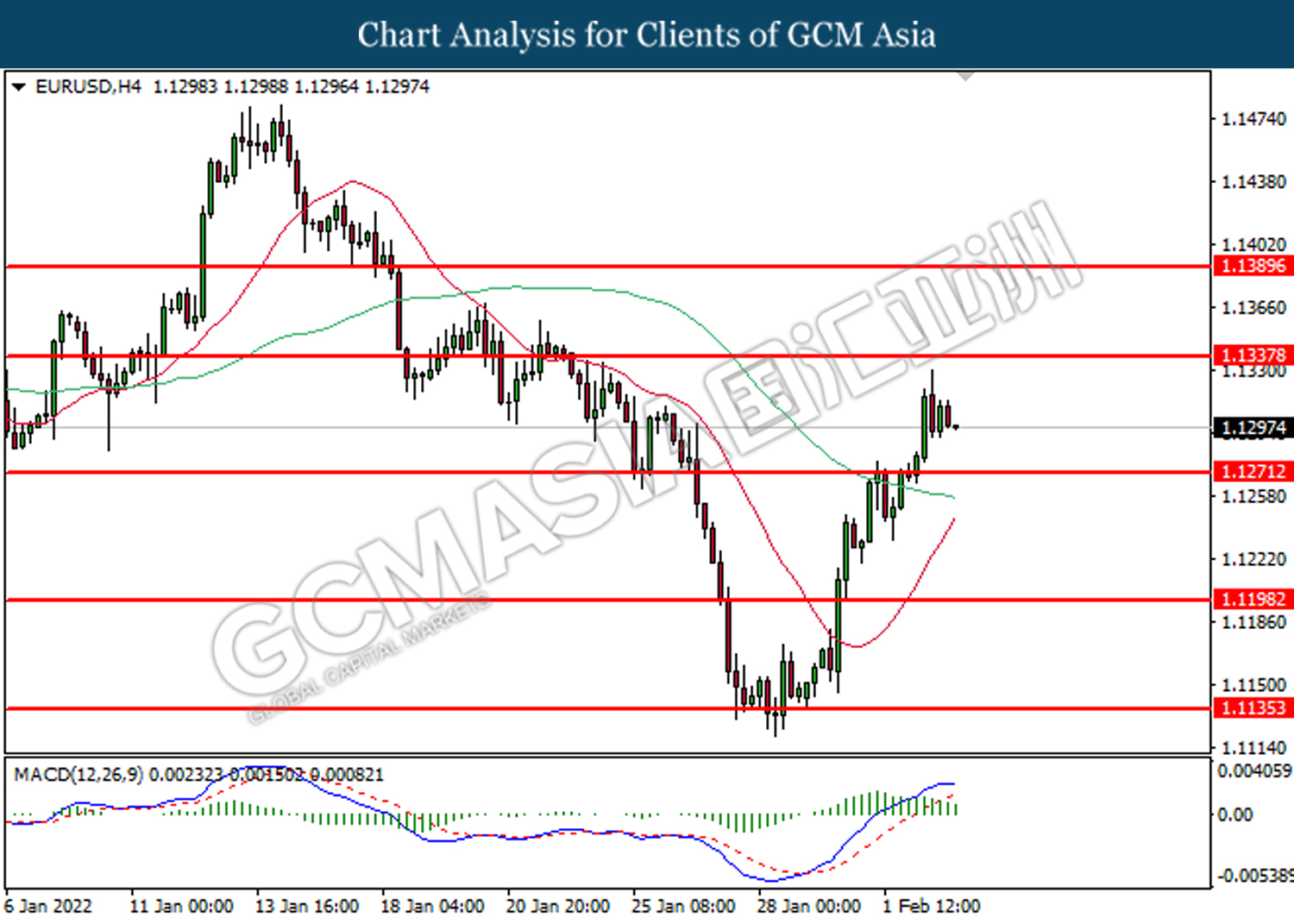

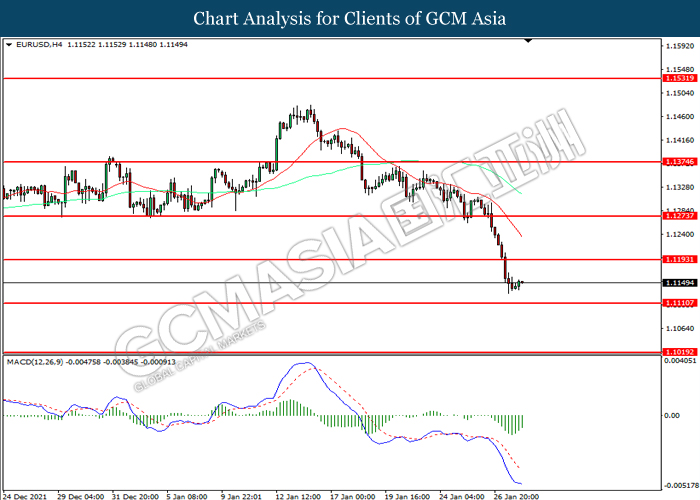

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1320

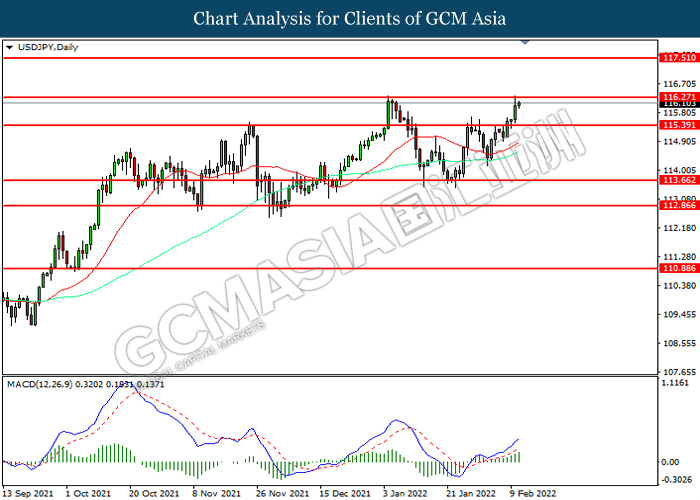

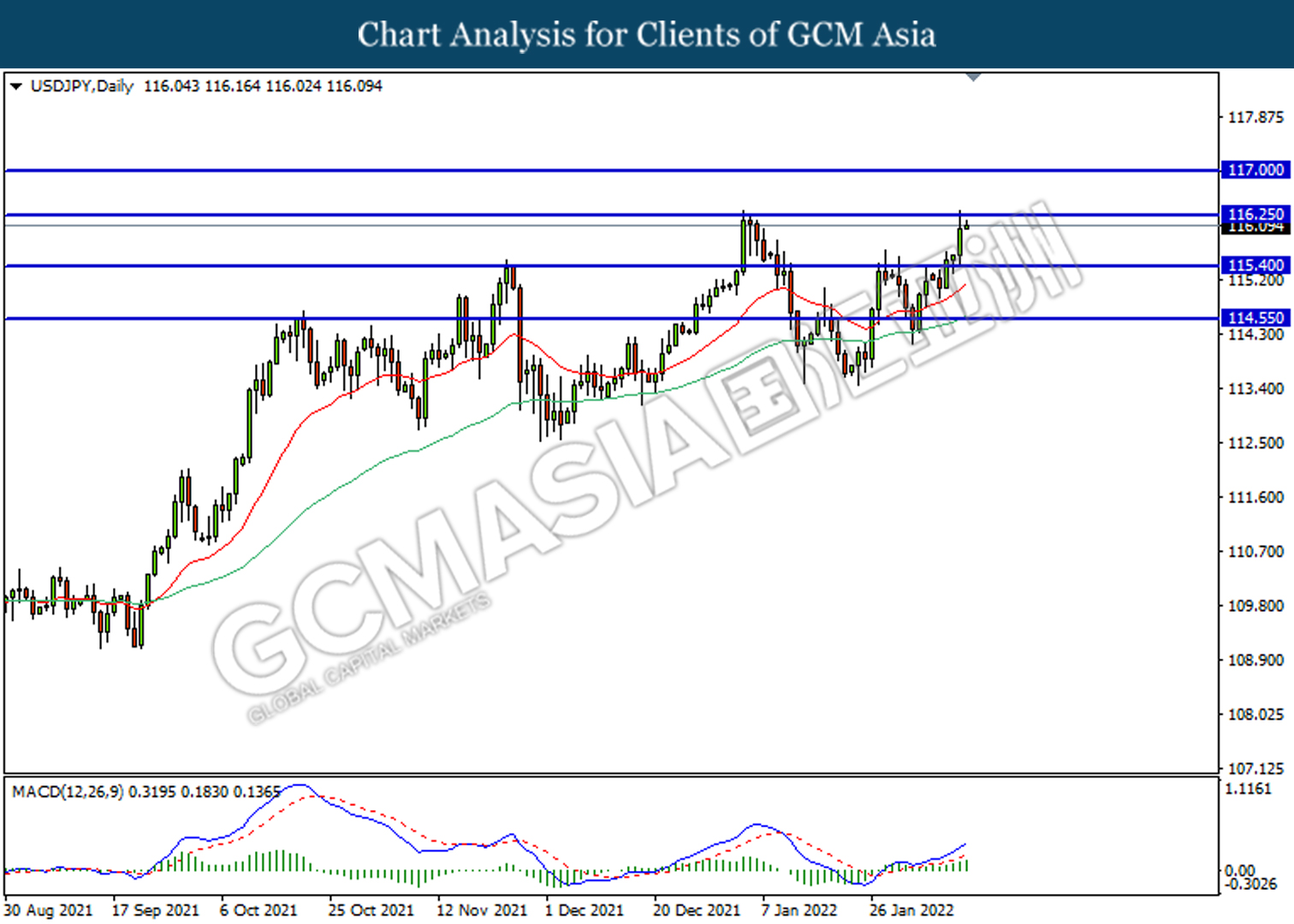

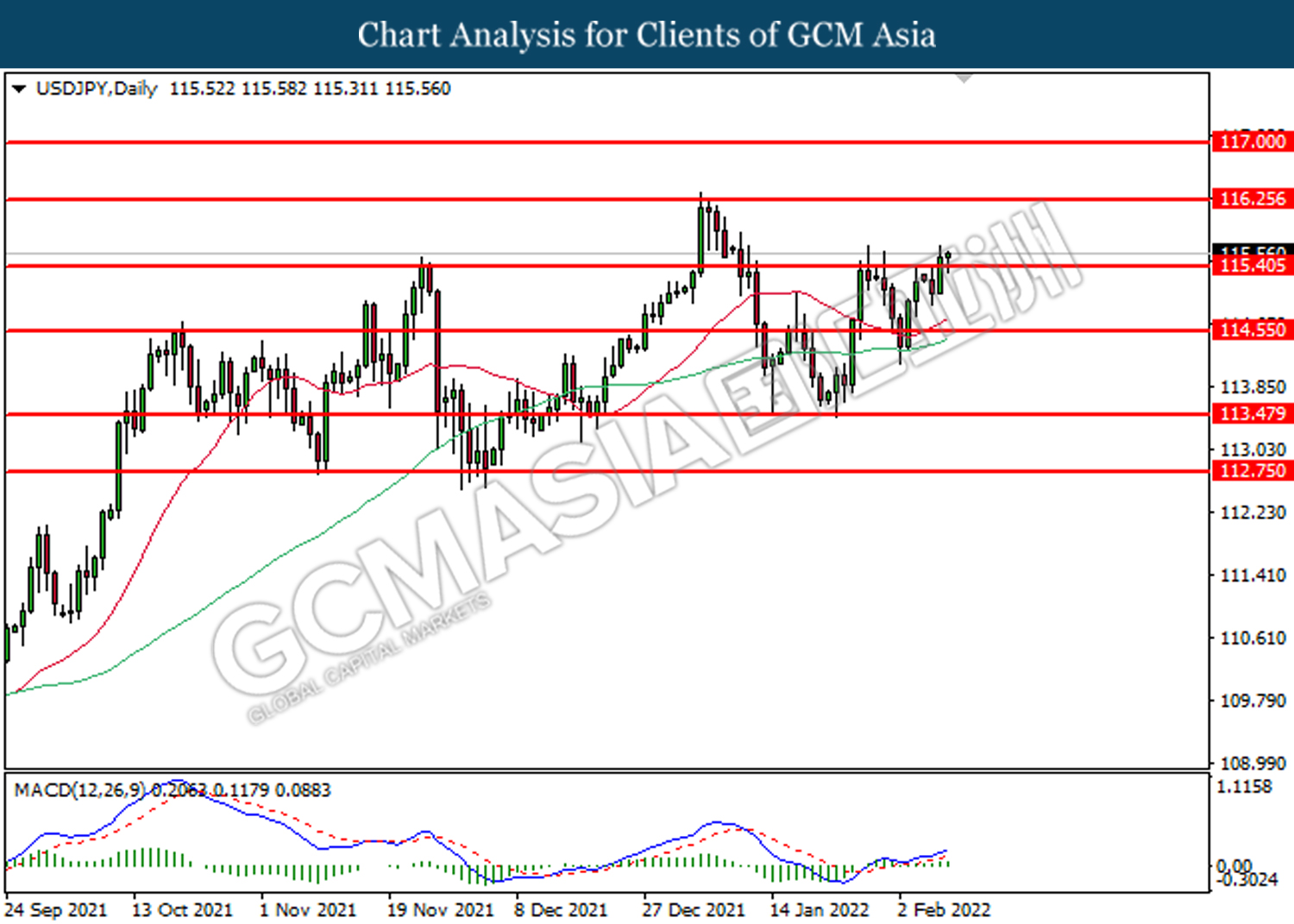

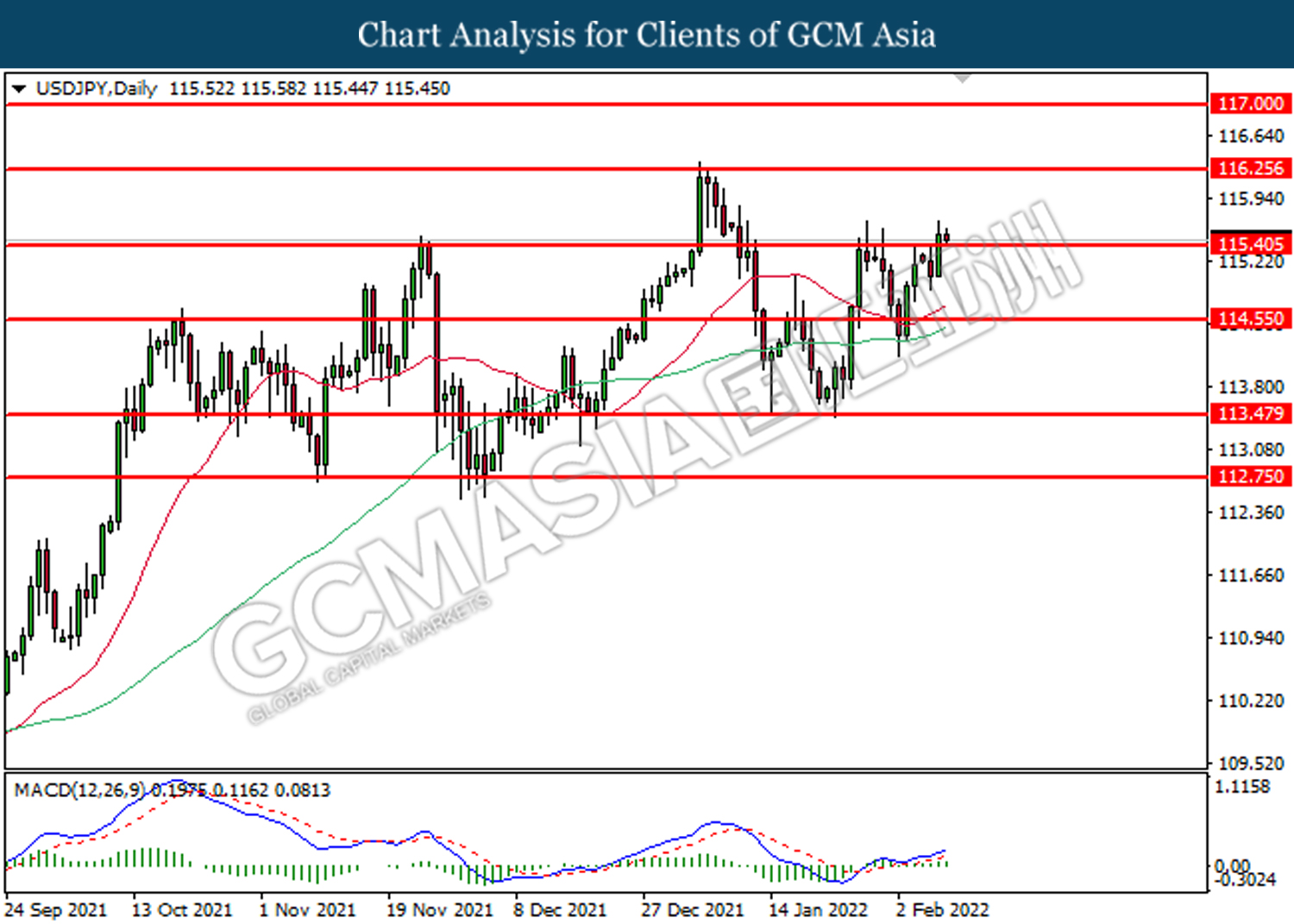

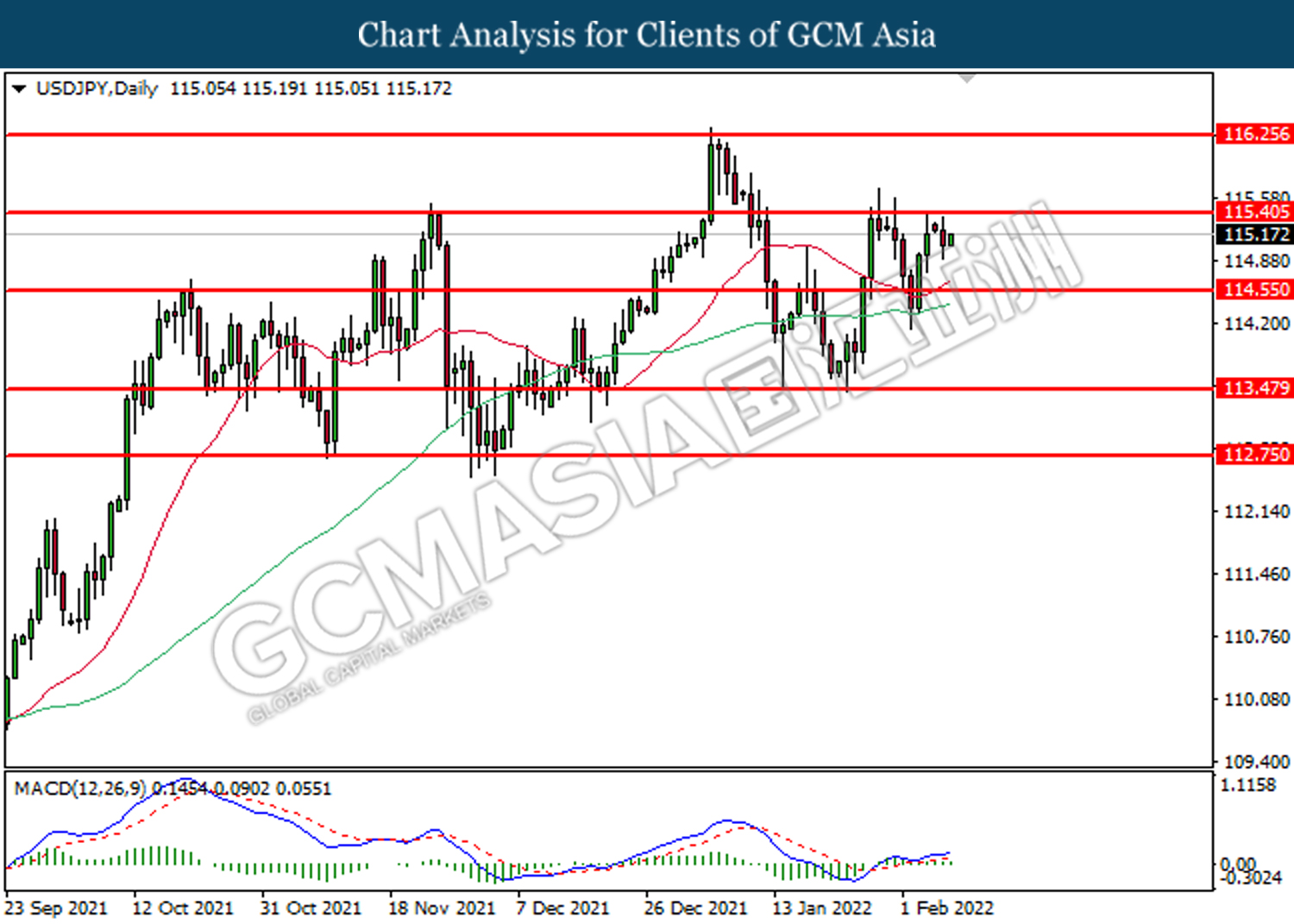

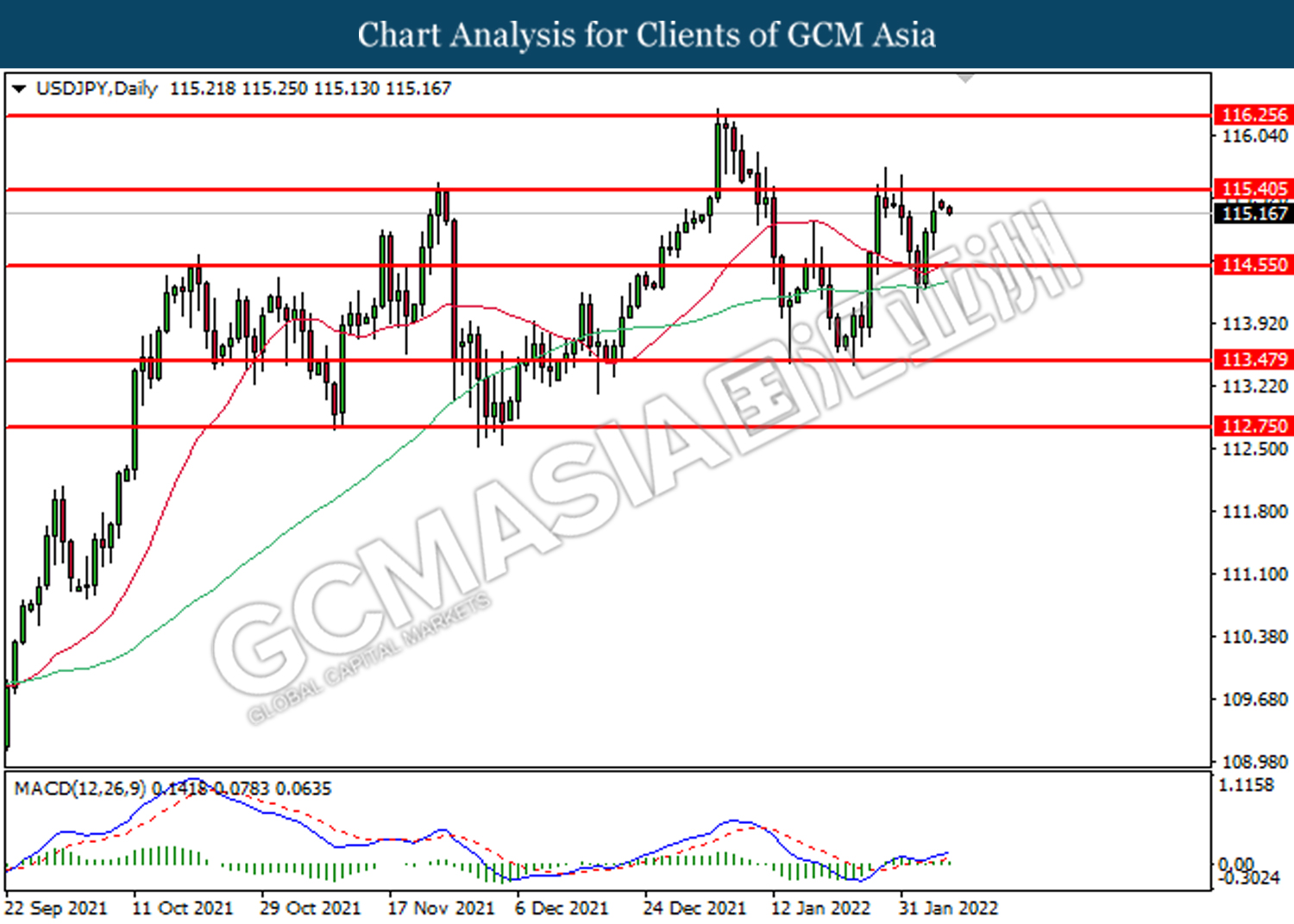

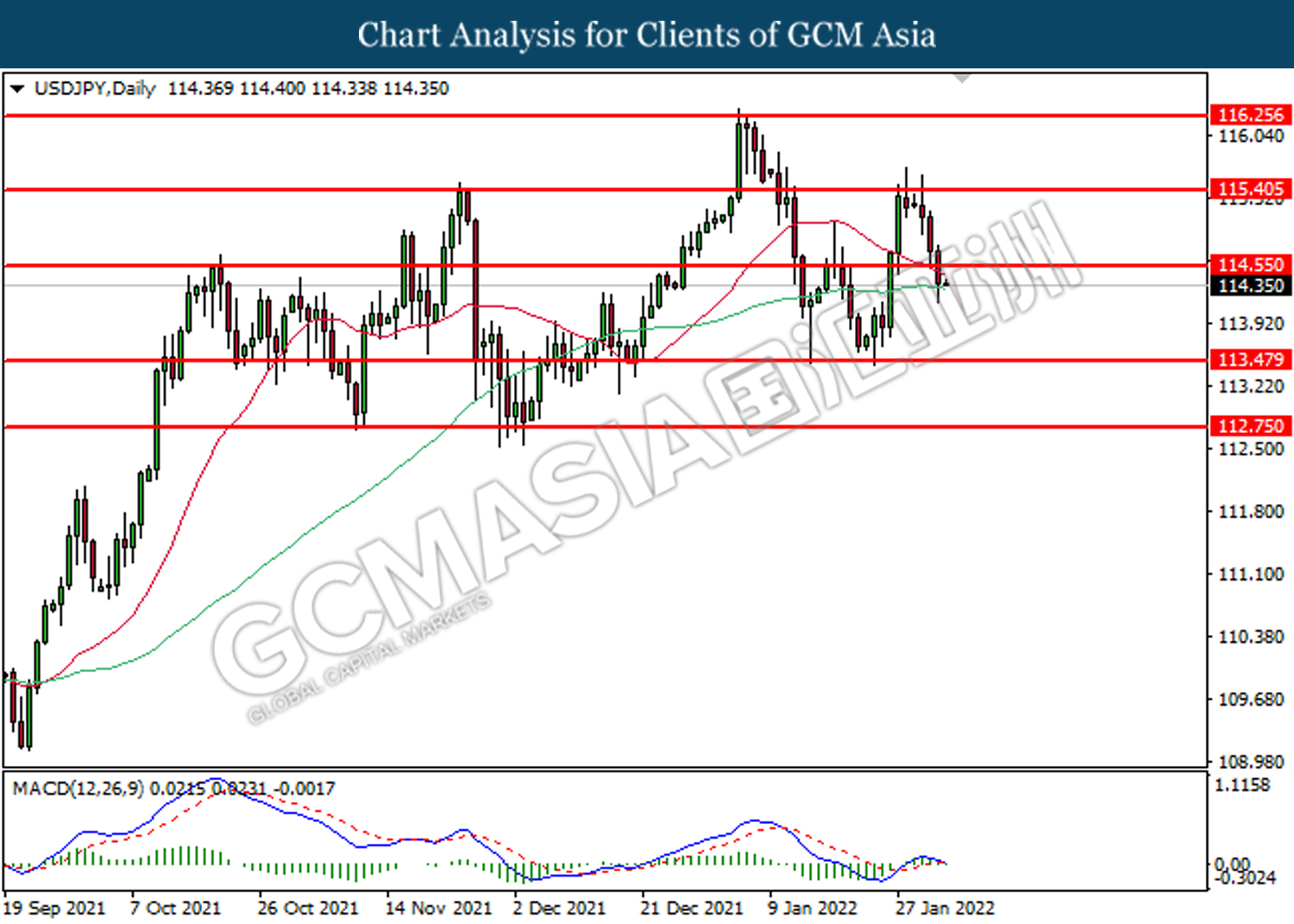

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 116.25. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 116.25, 117.50

Support level: 115.40, 113.65

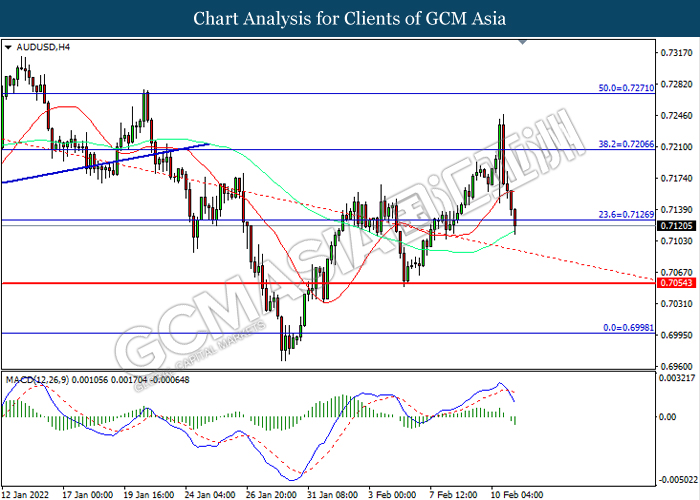

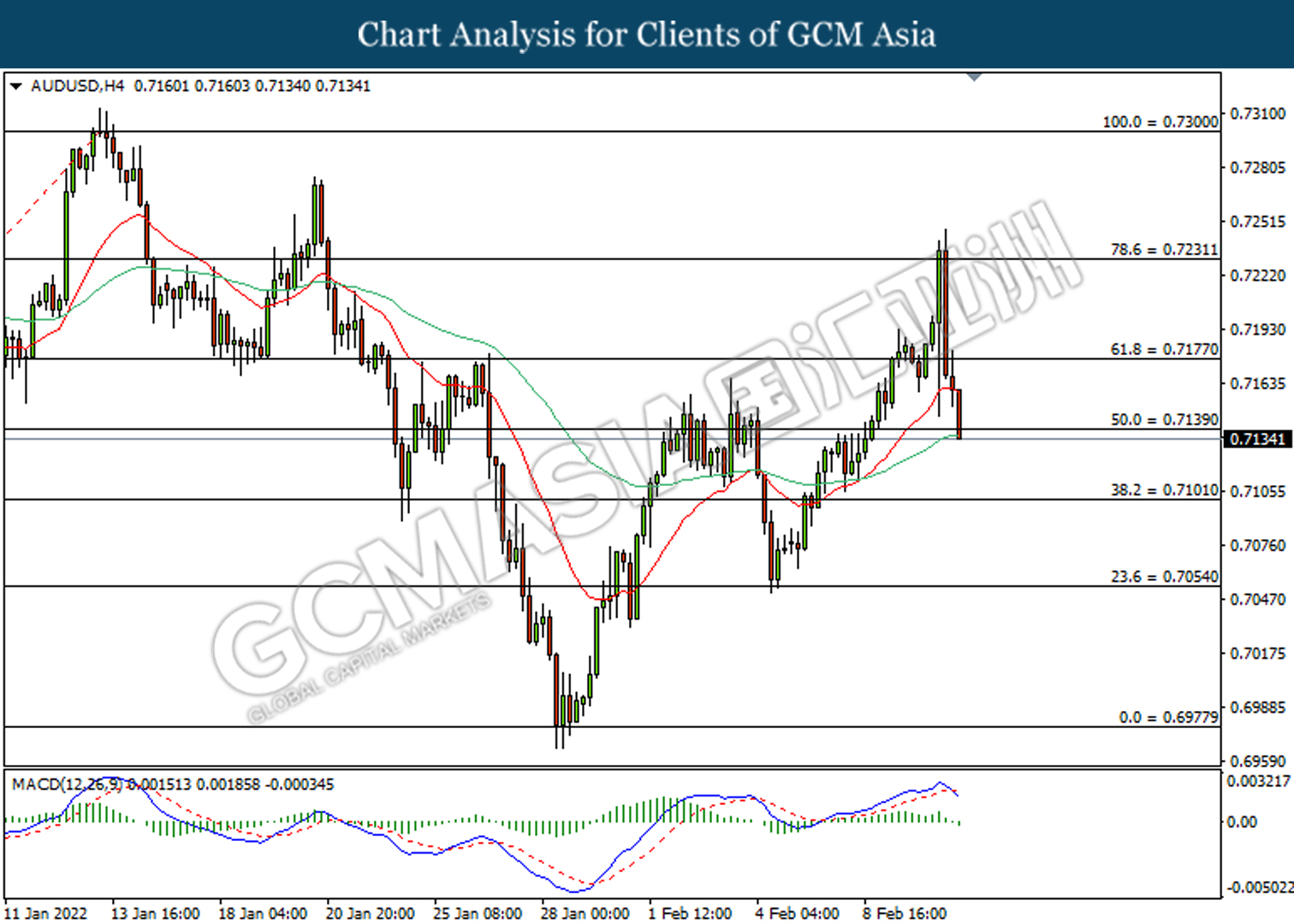

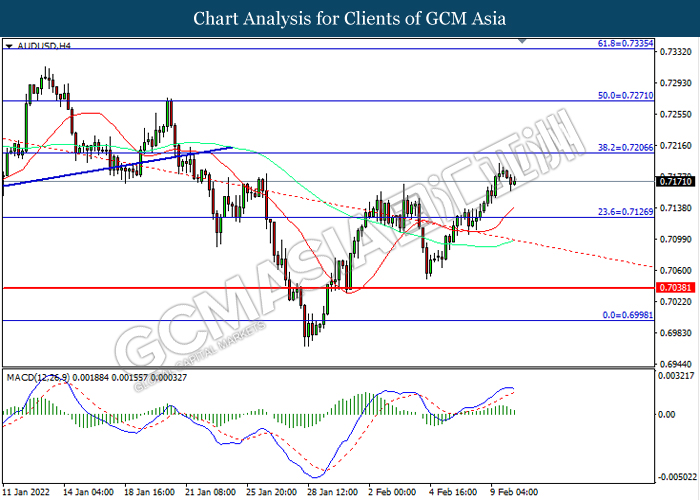

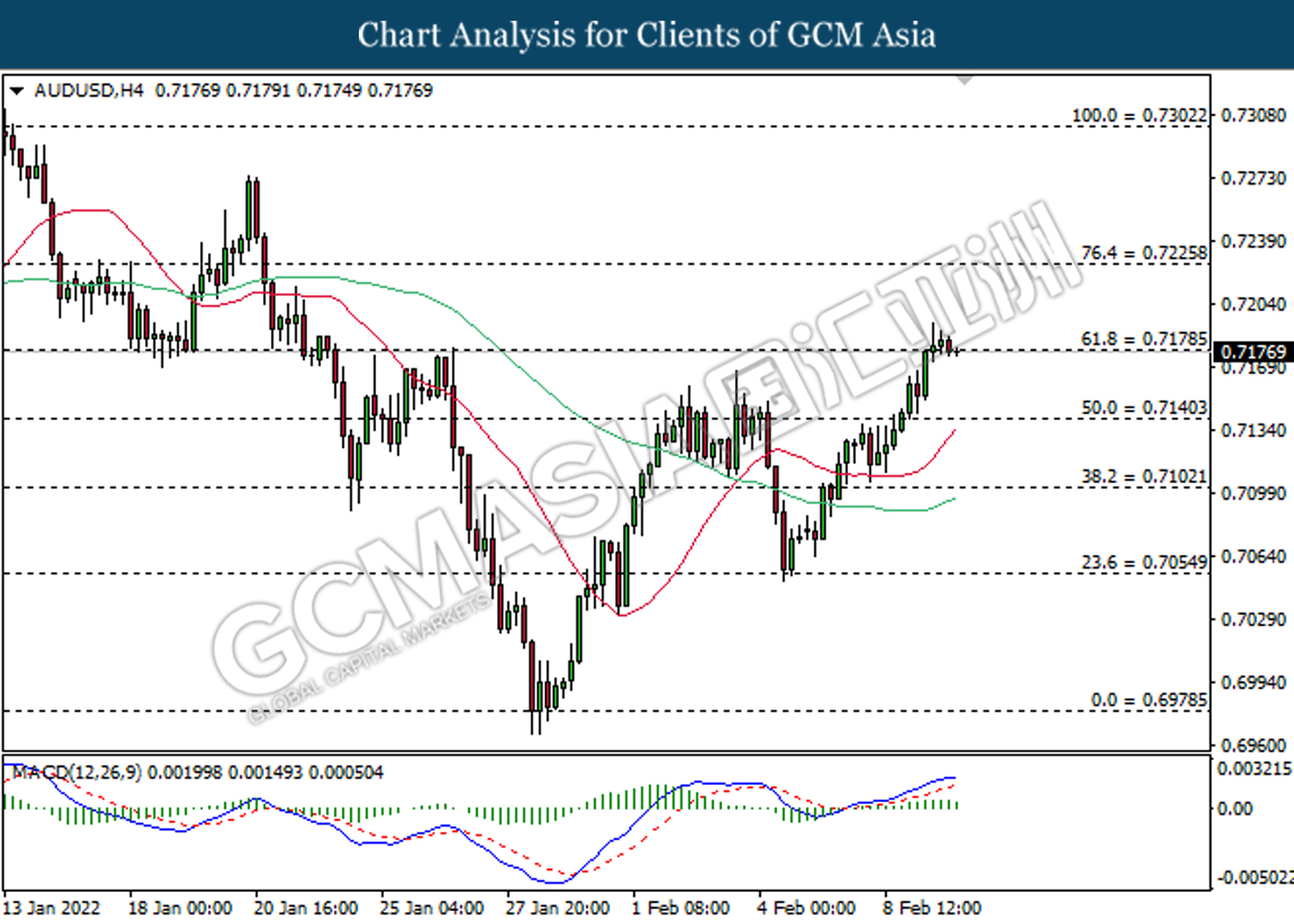

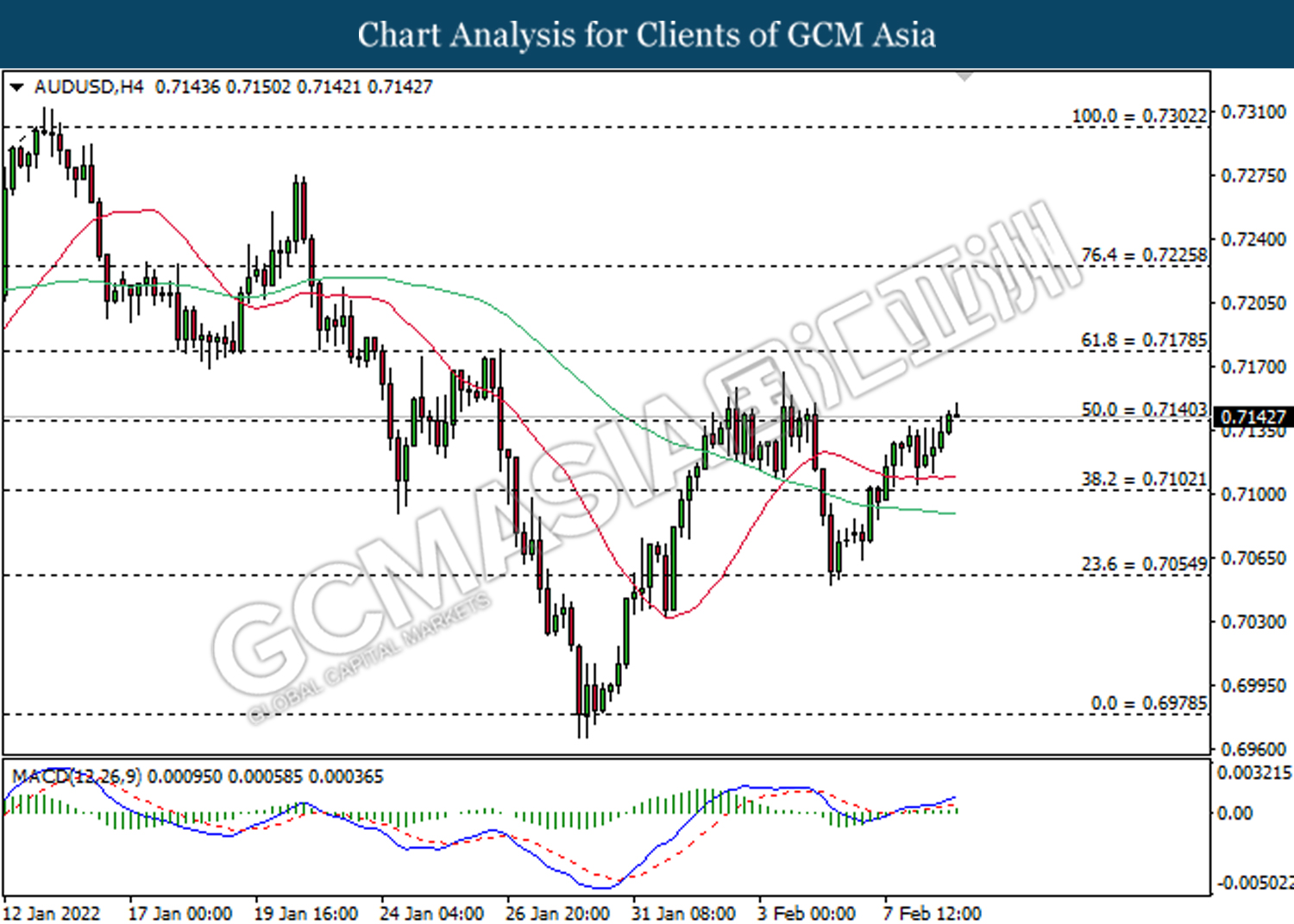

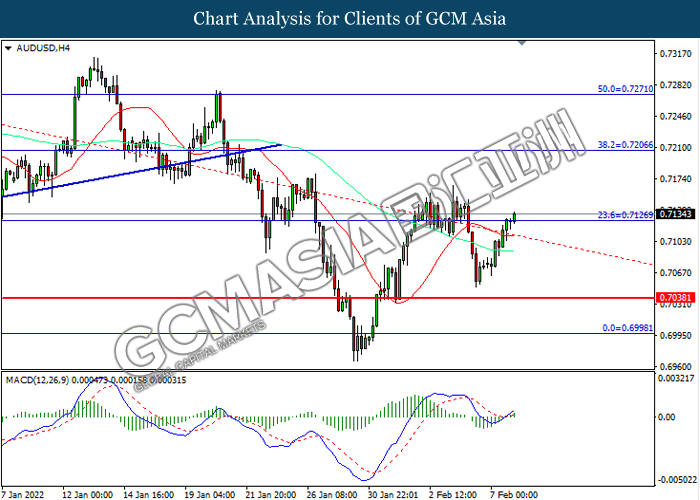

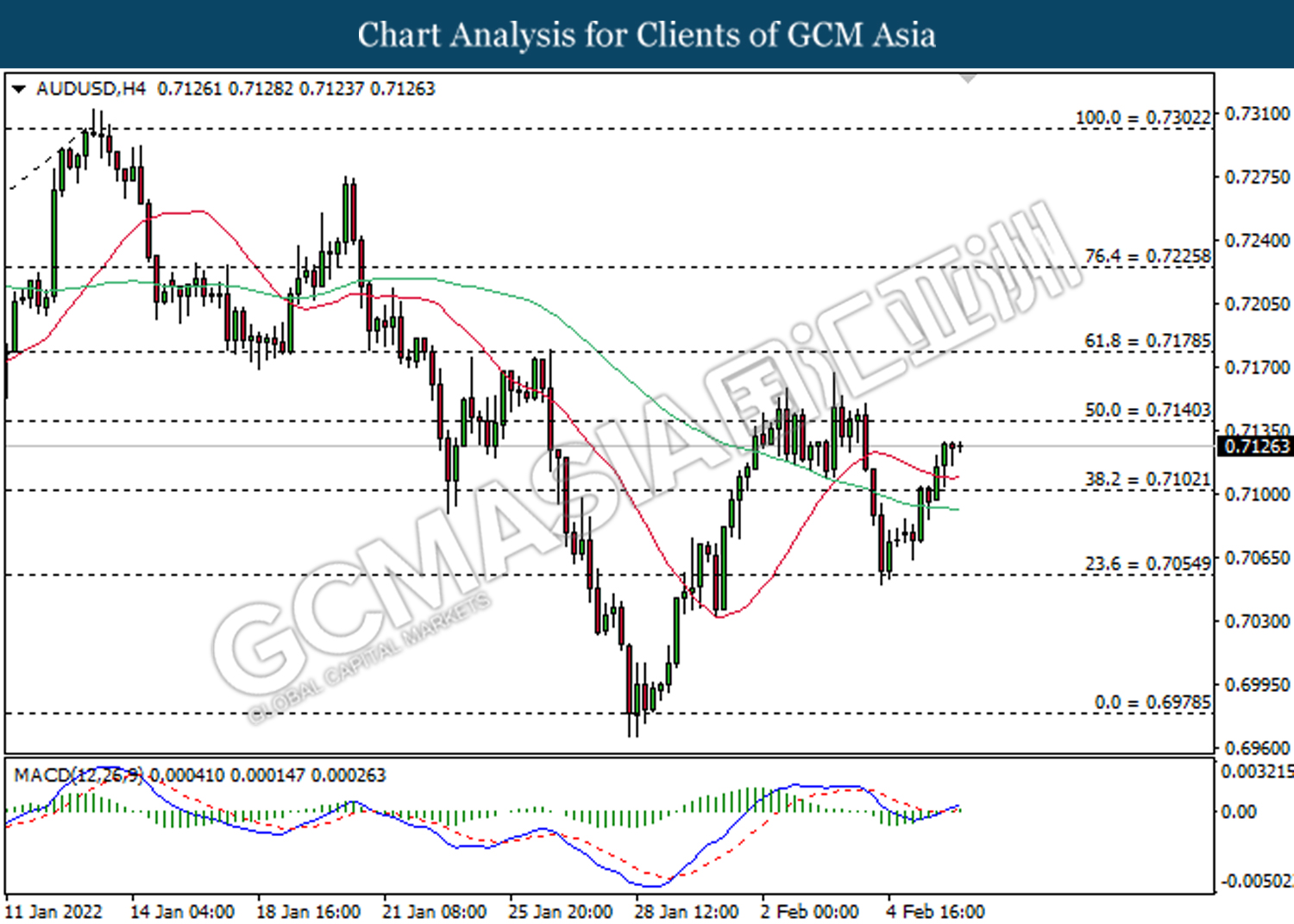

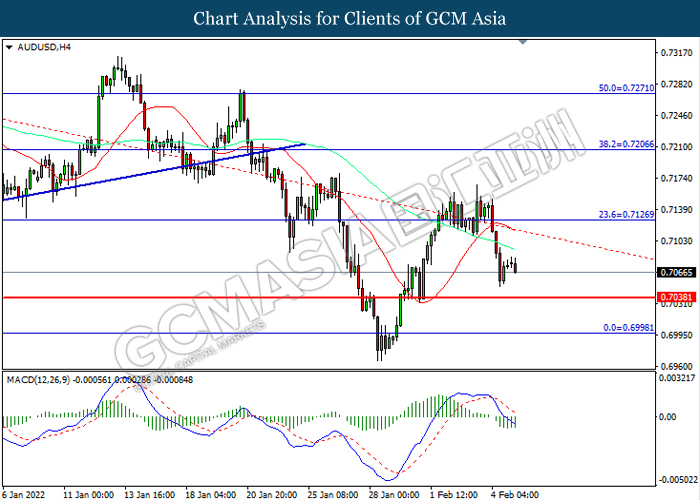

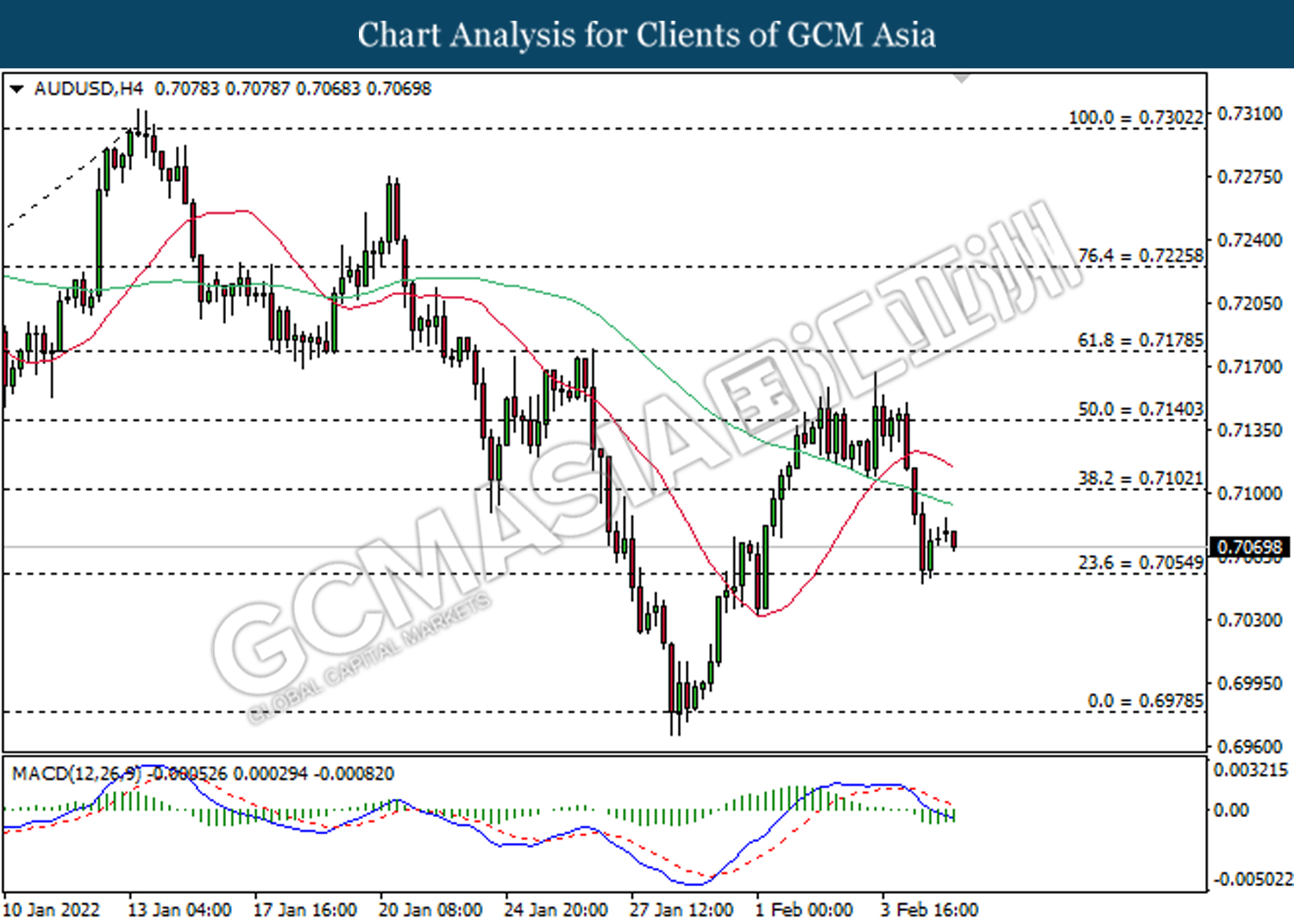

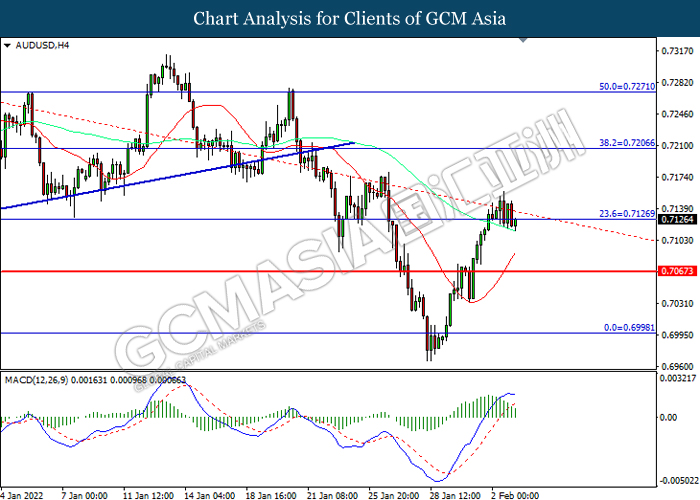

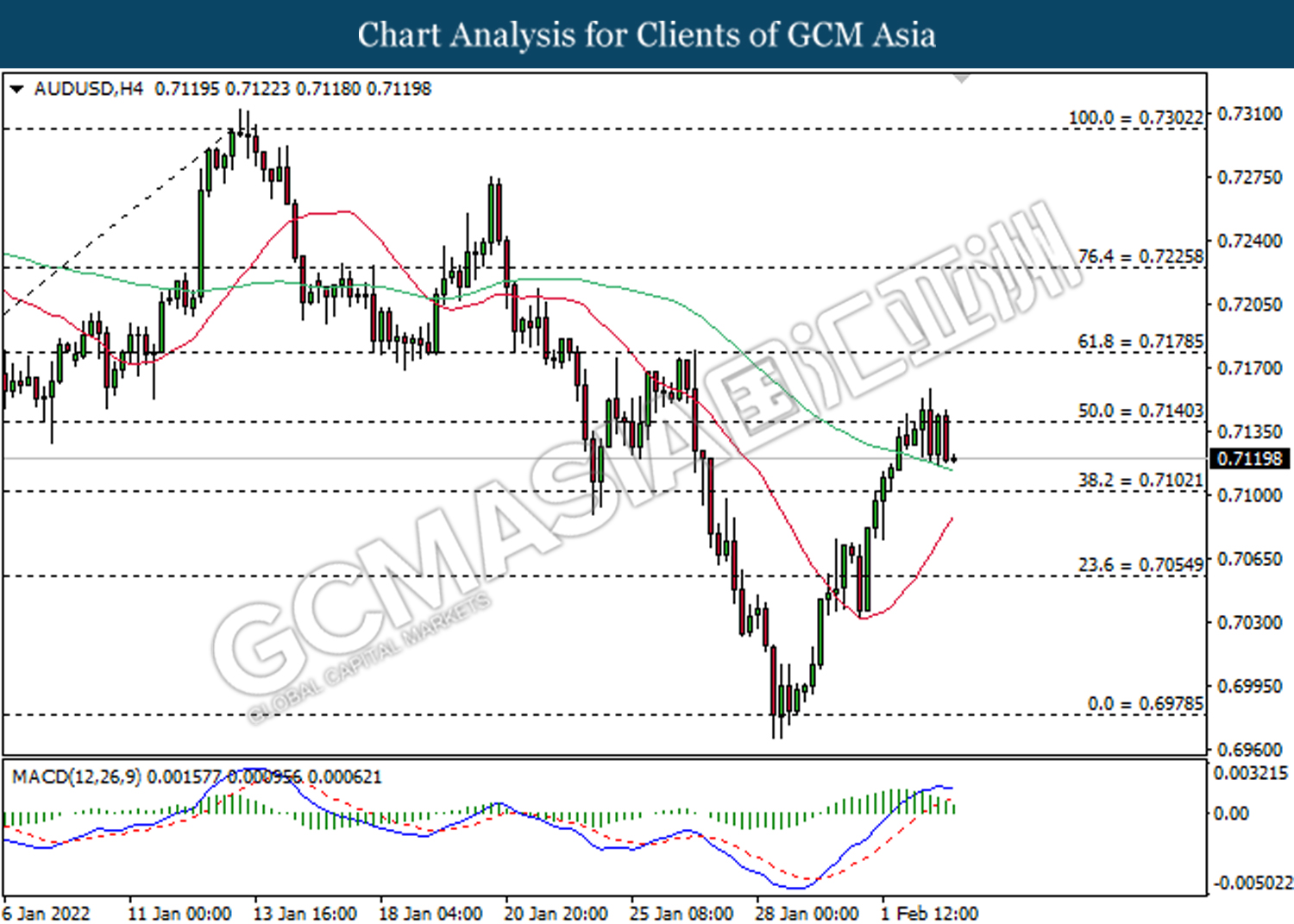

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7125. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

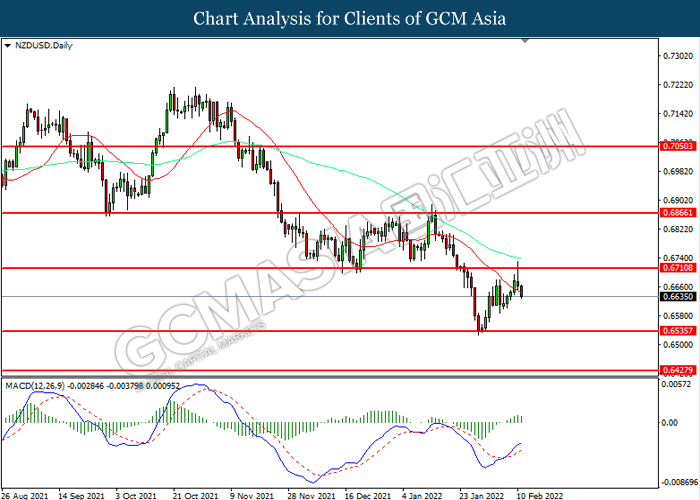

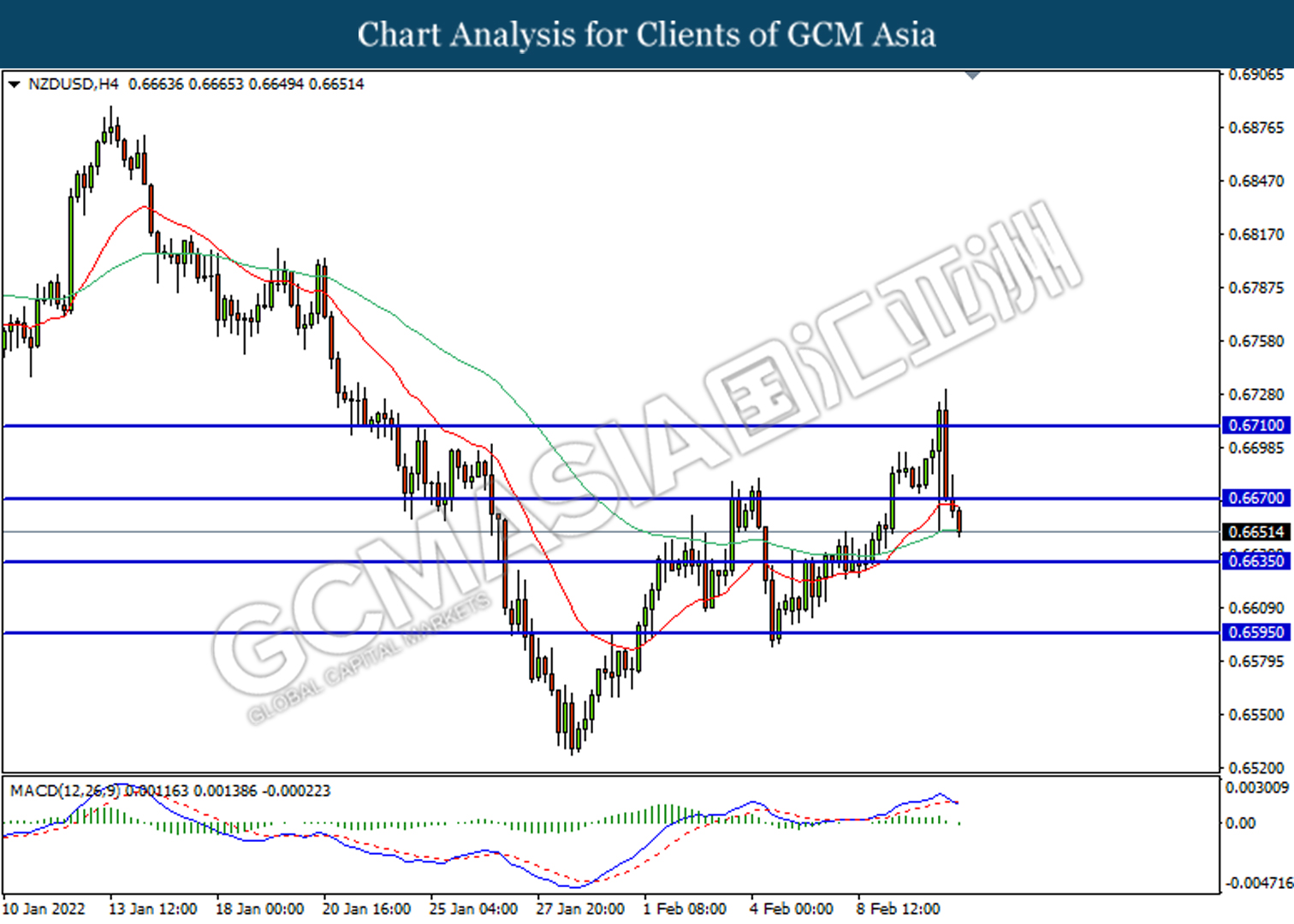

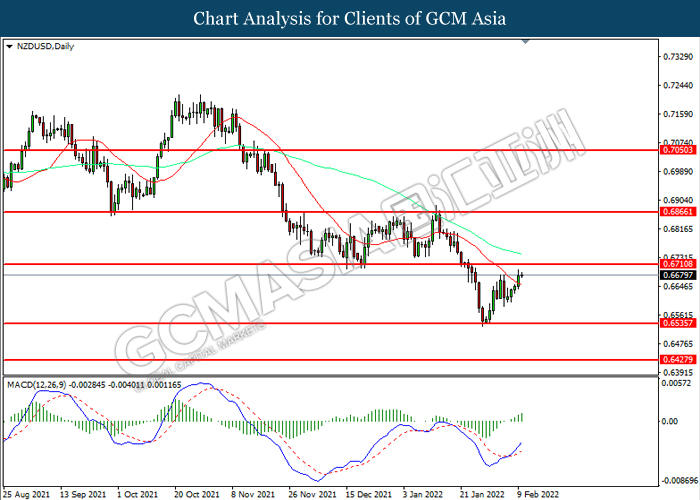

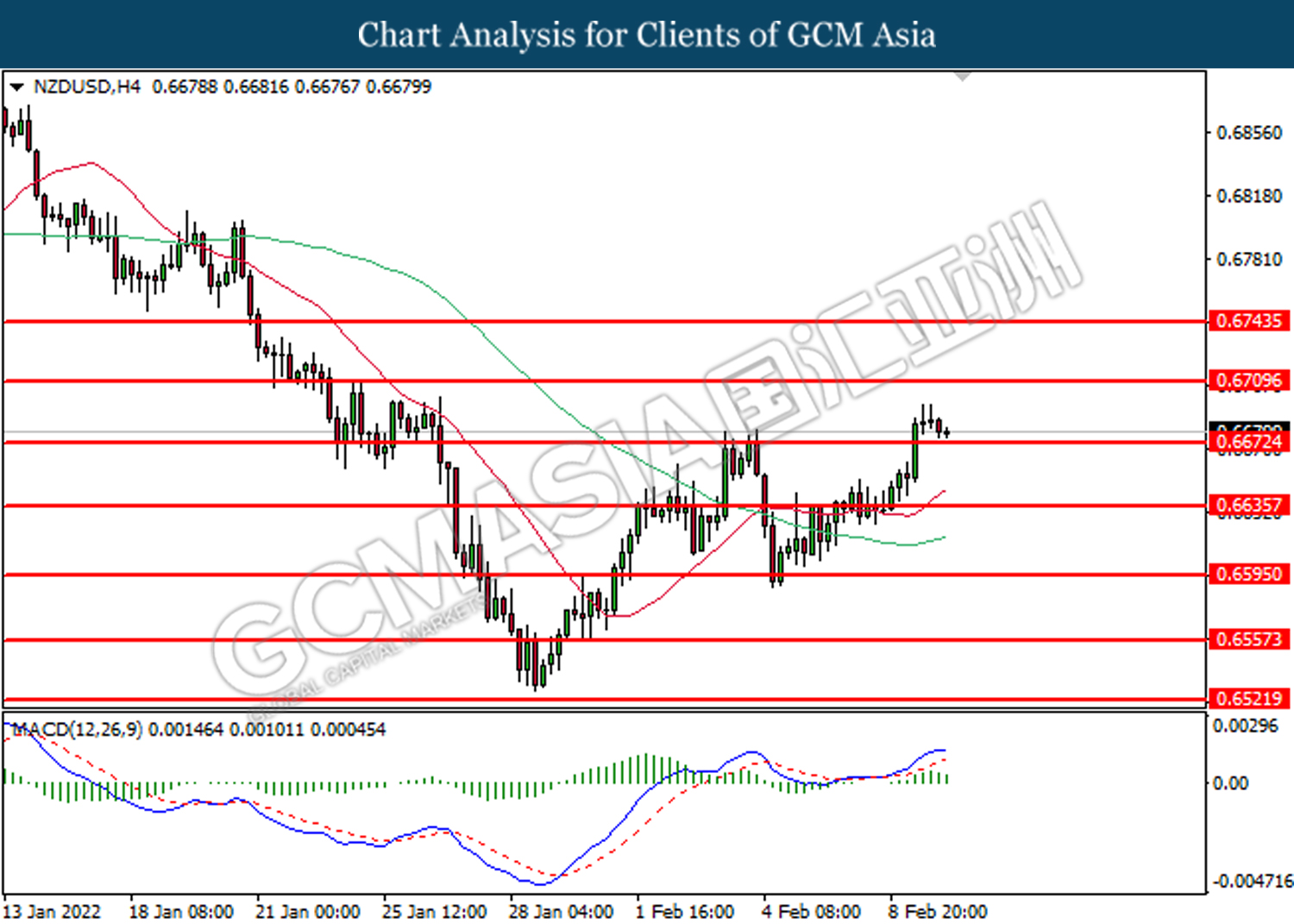

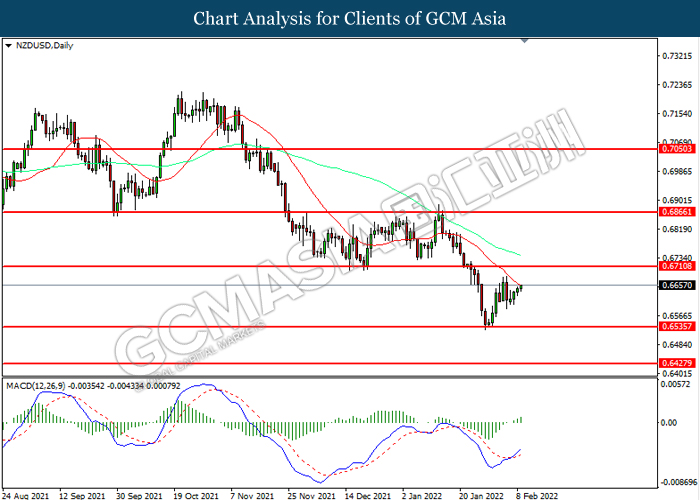

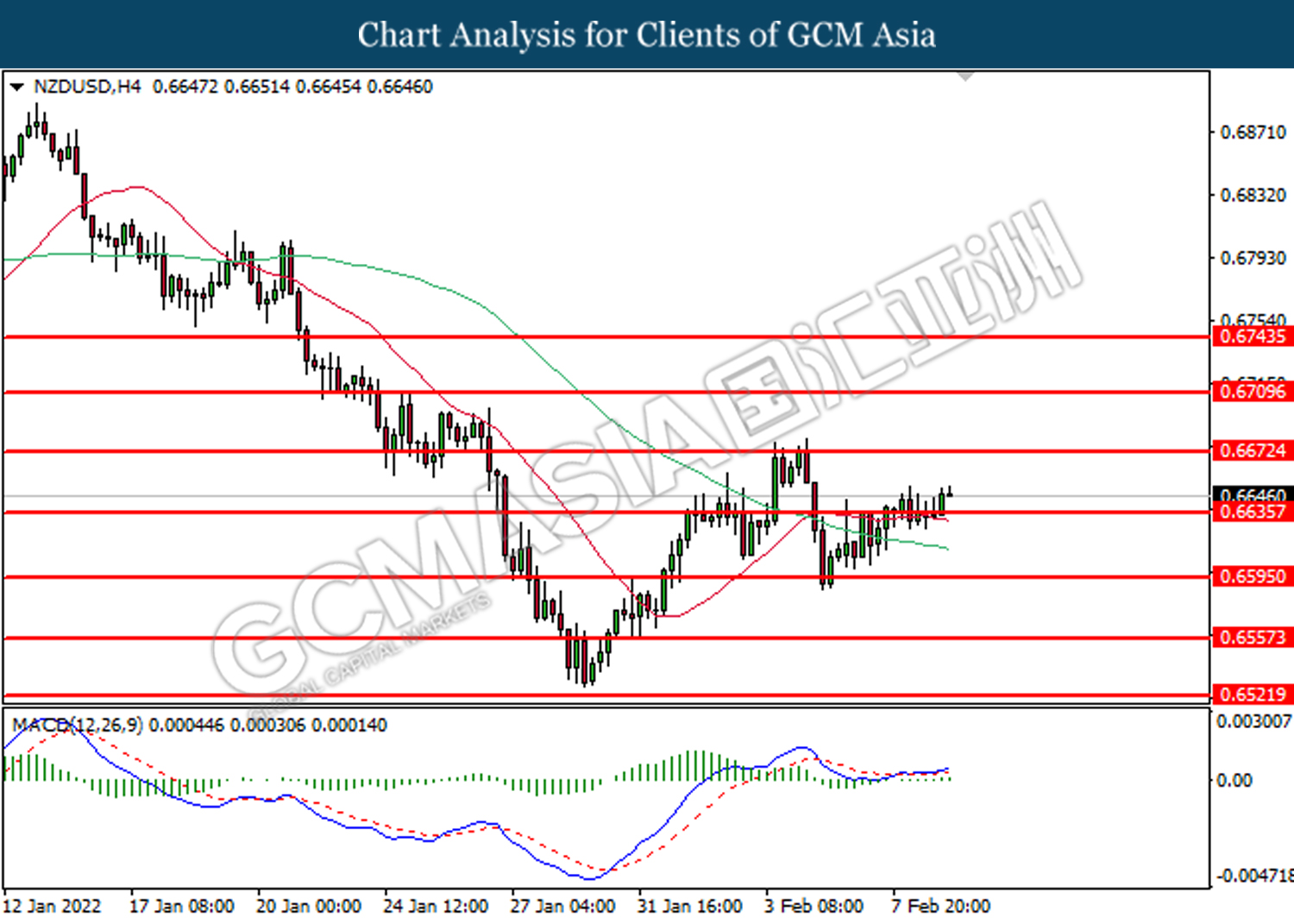

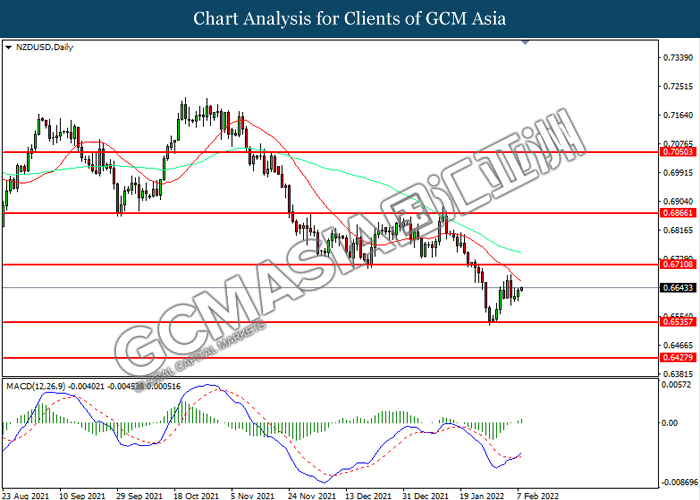

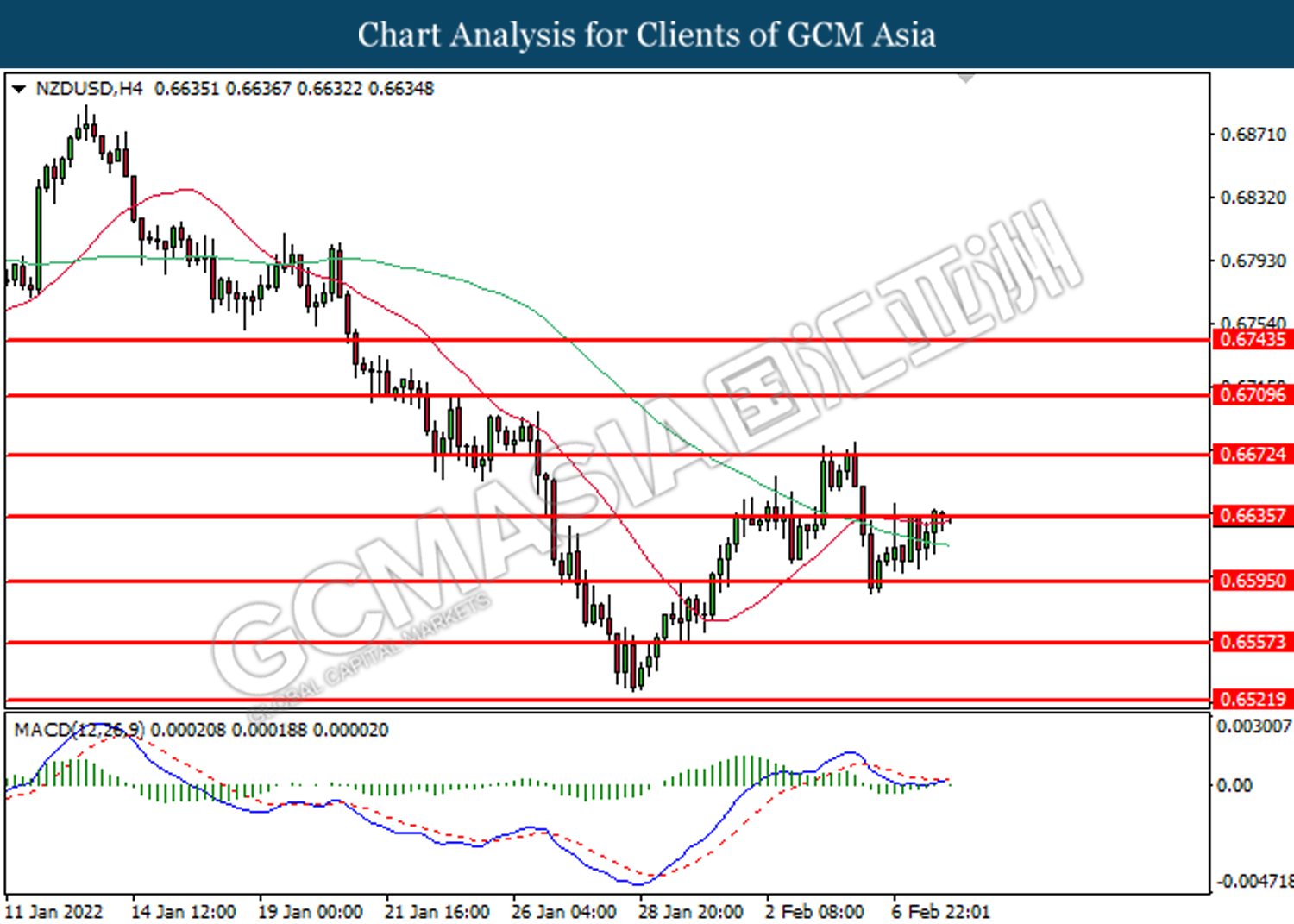

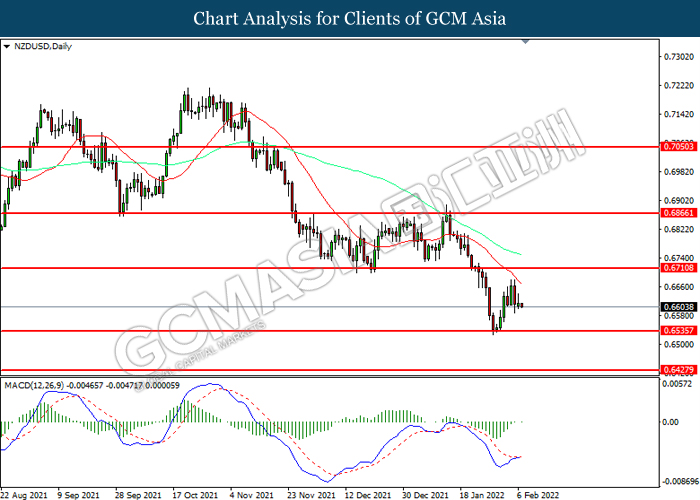

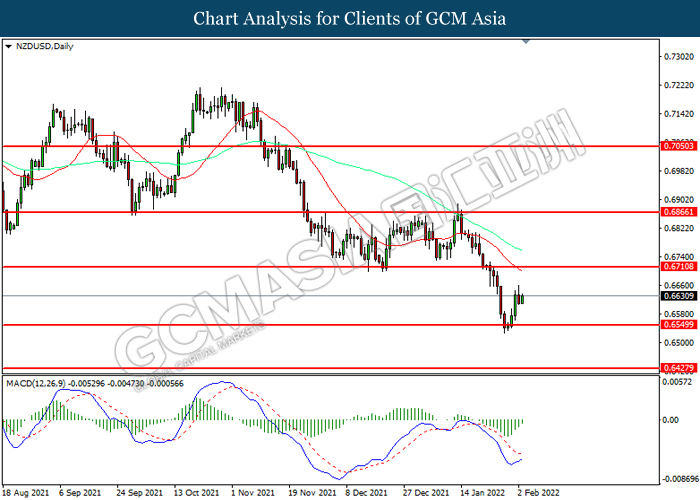

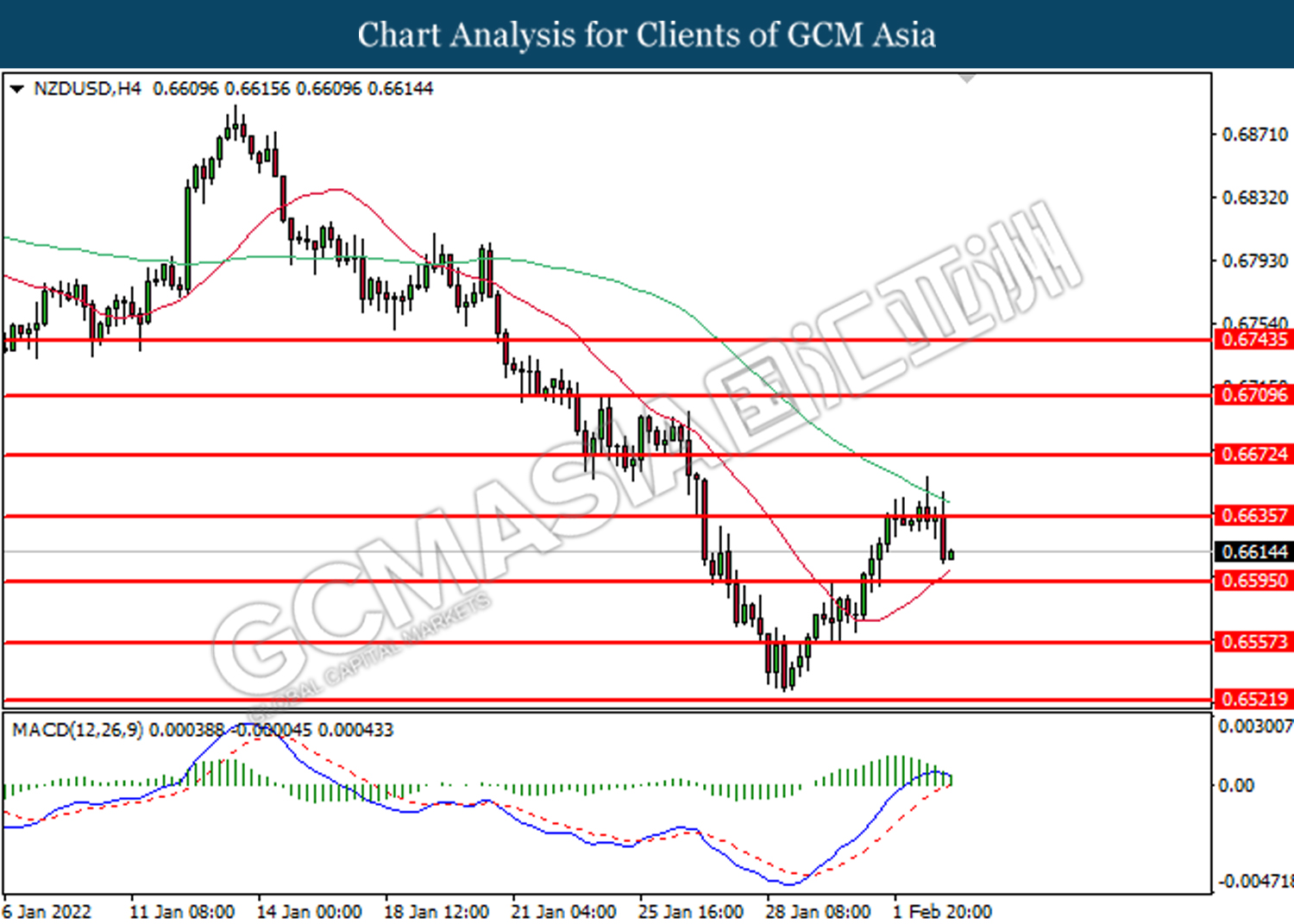

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6710. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6535.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

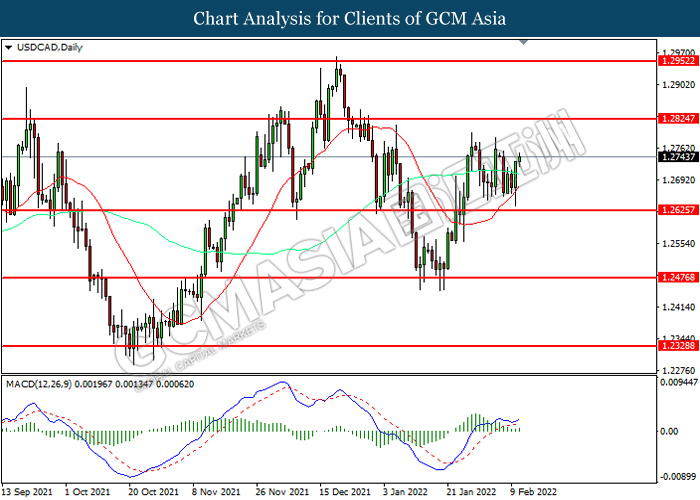

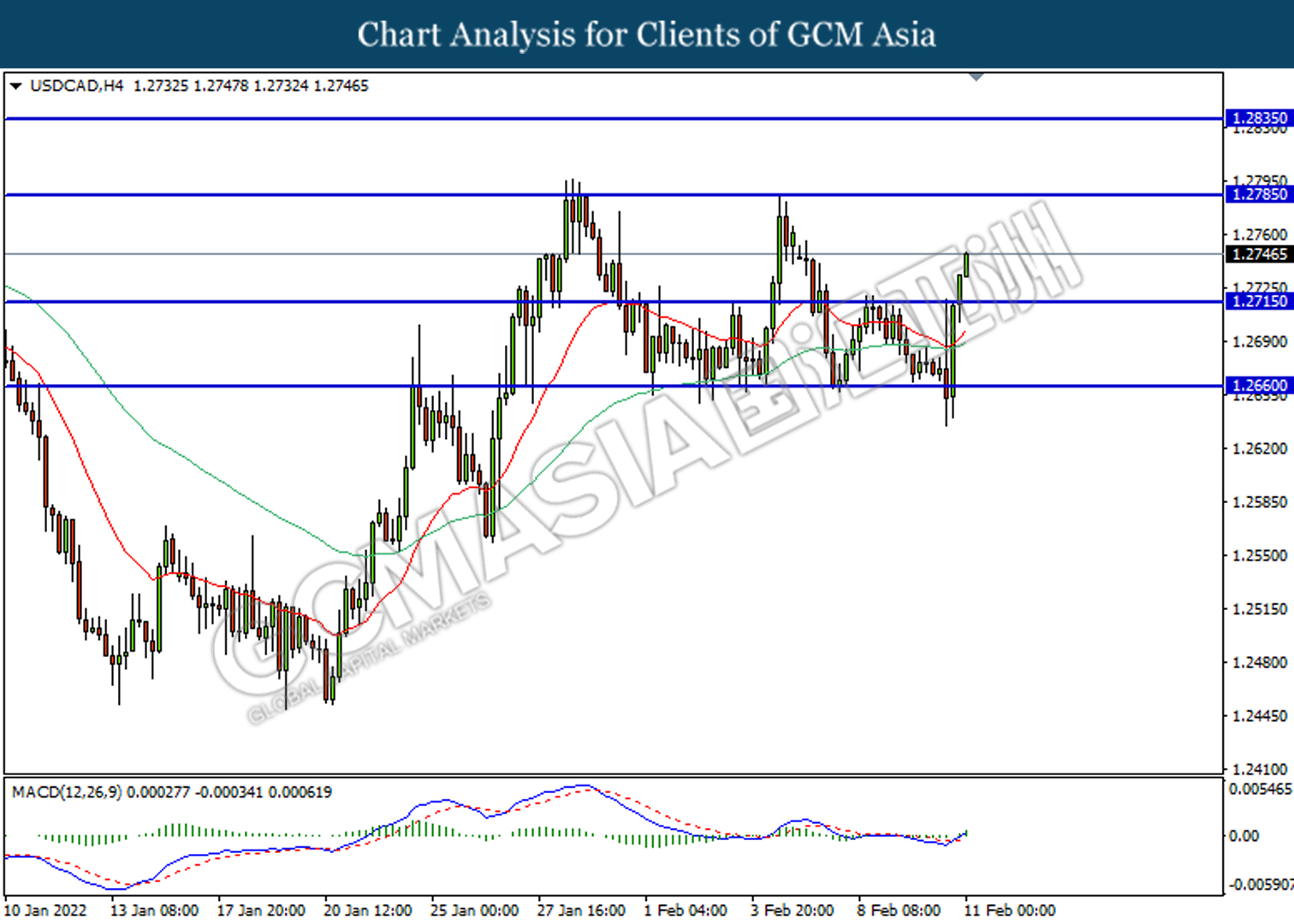

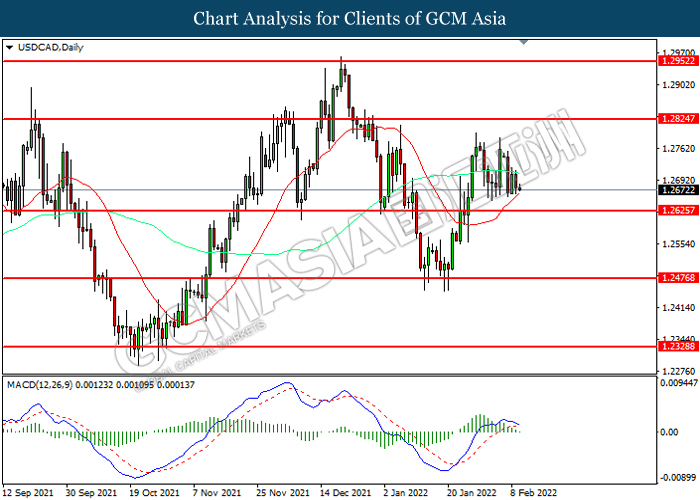

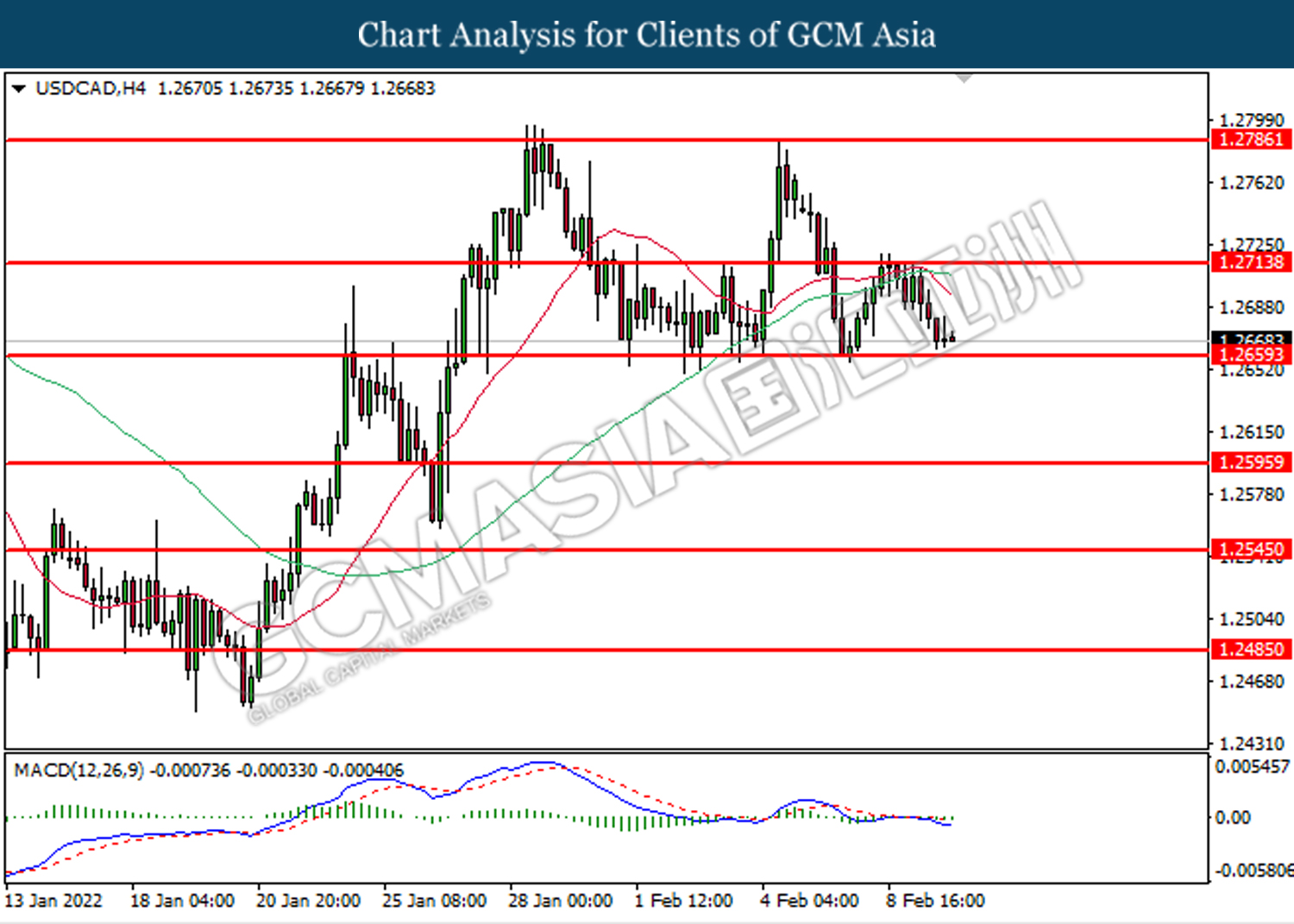

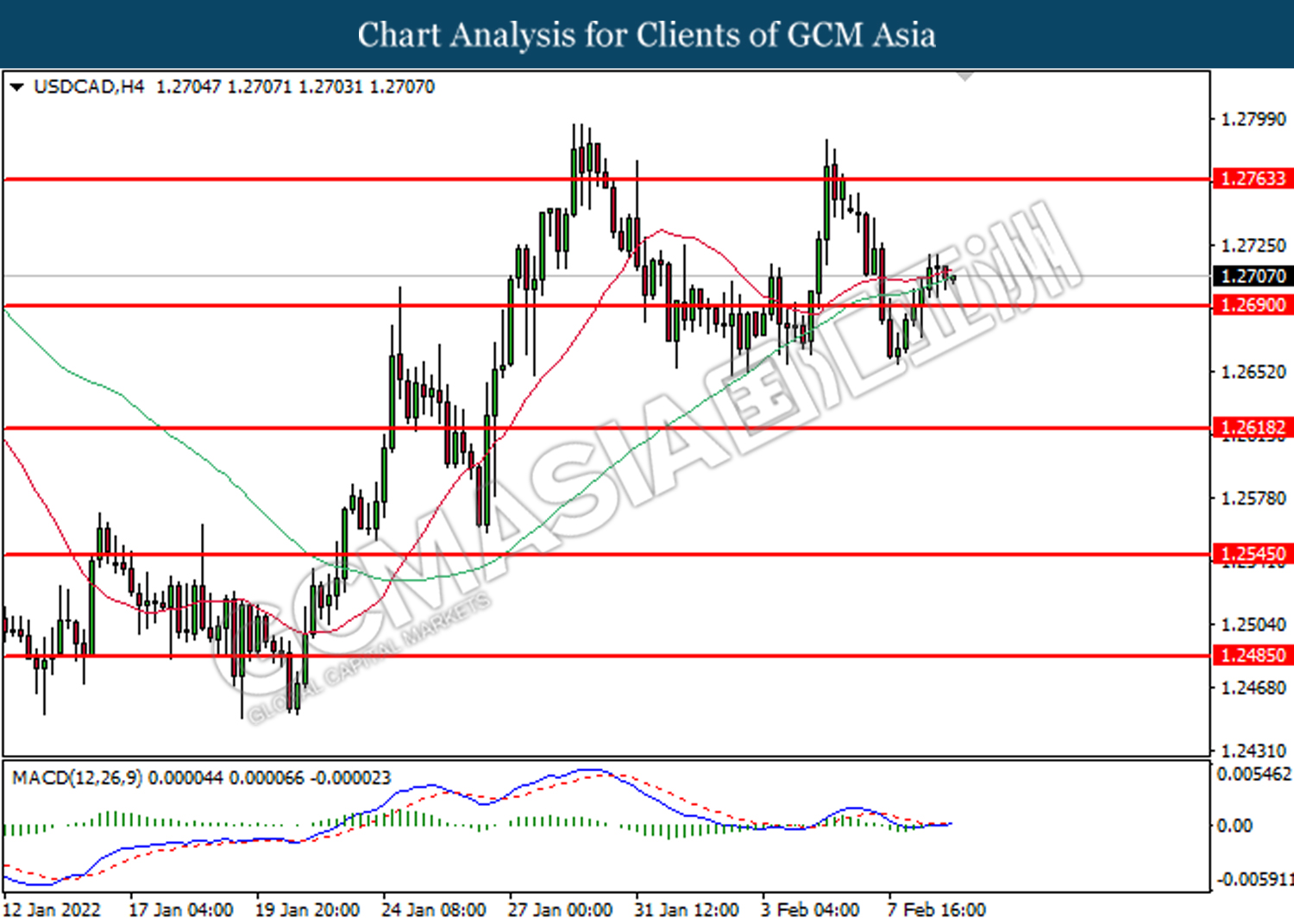

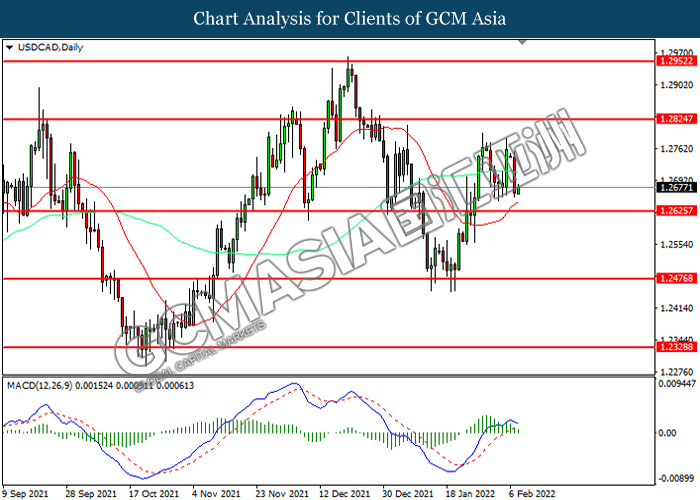

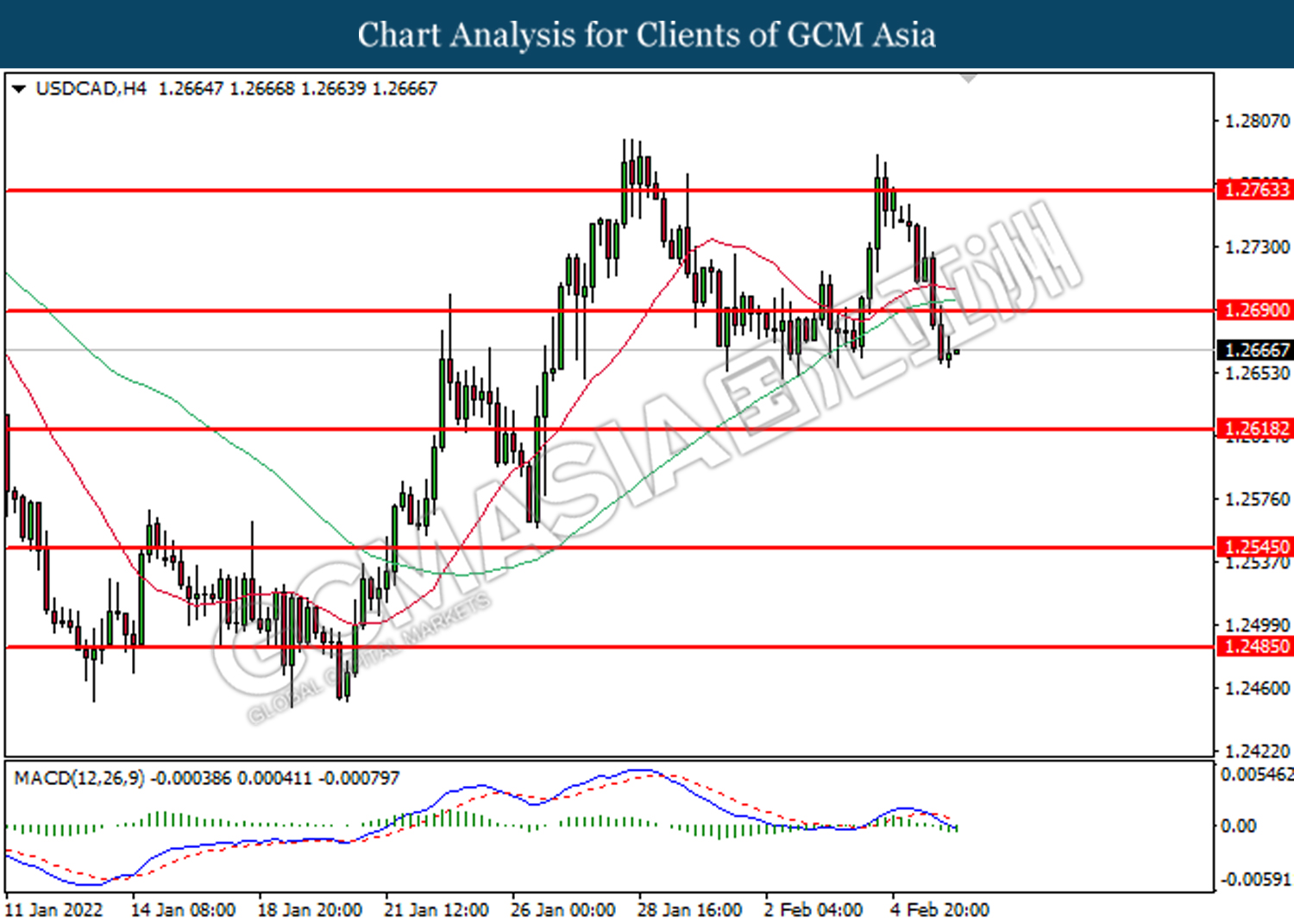

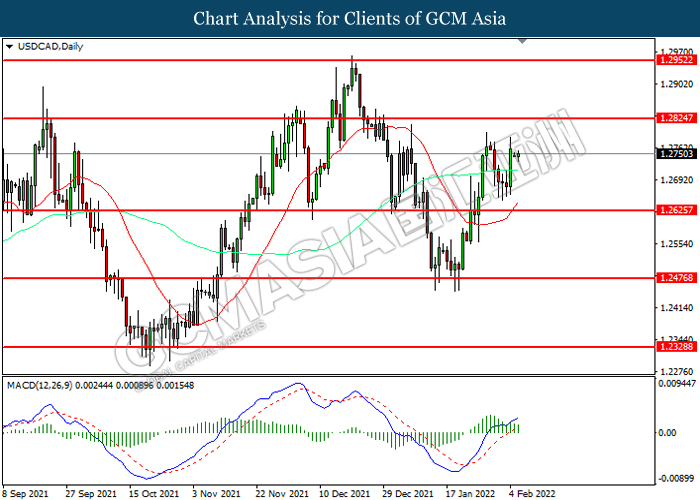

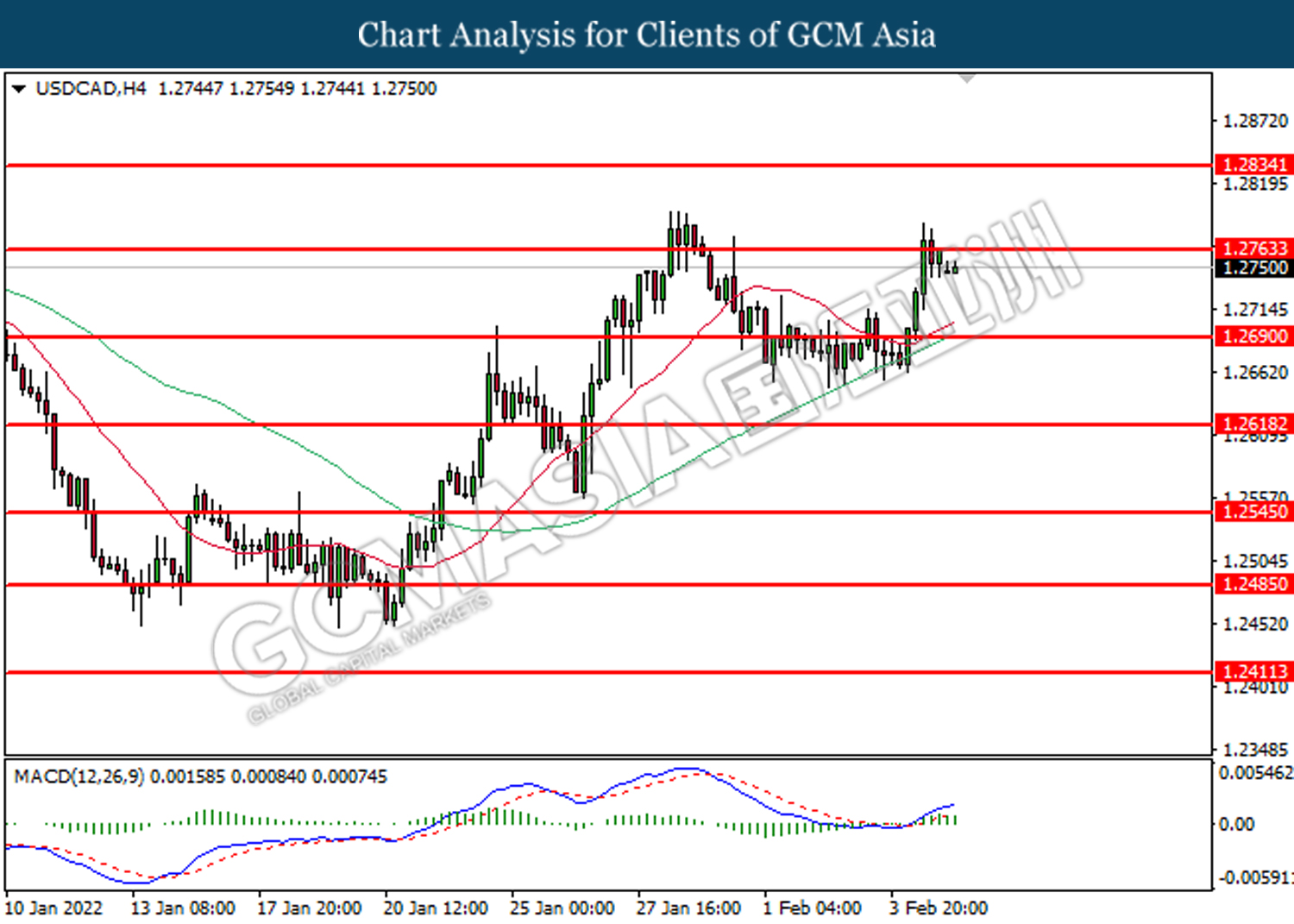

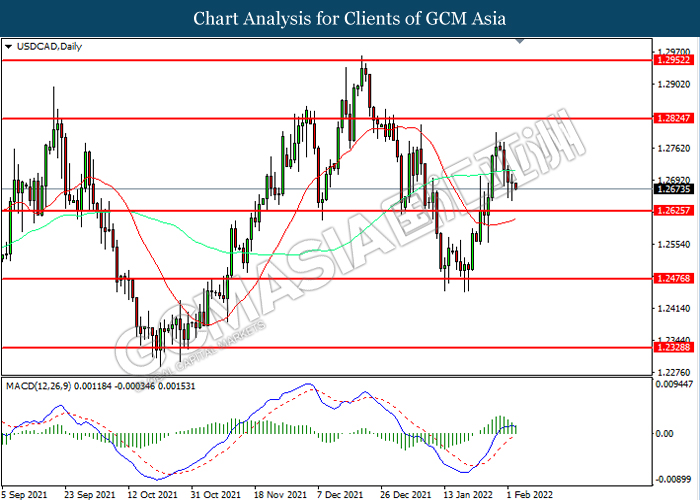

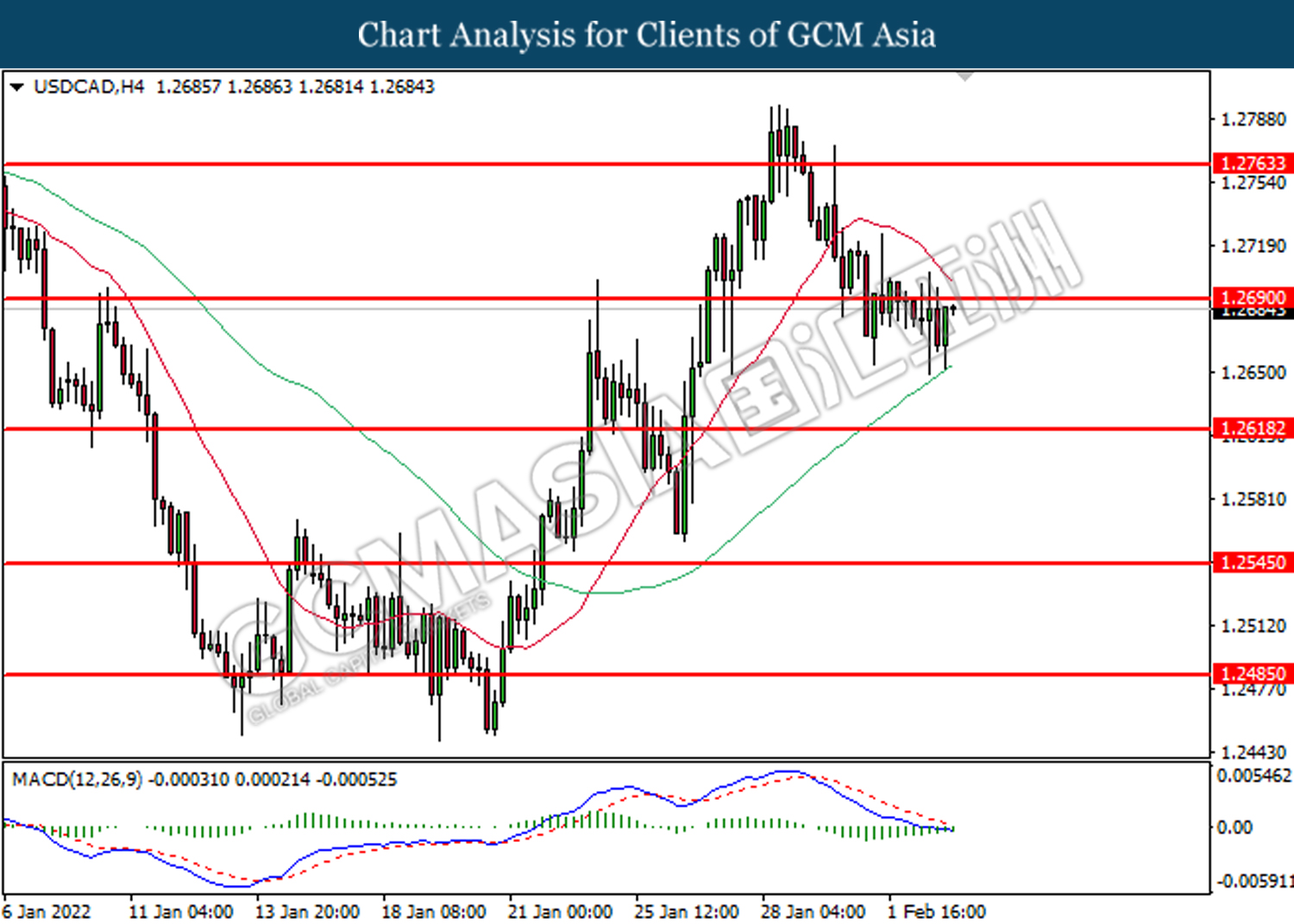

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

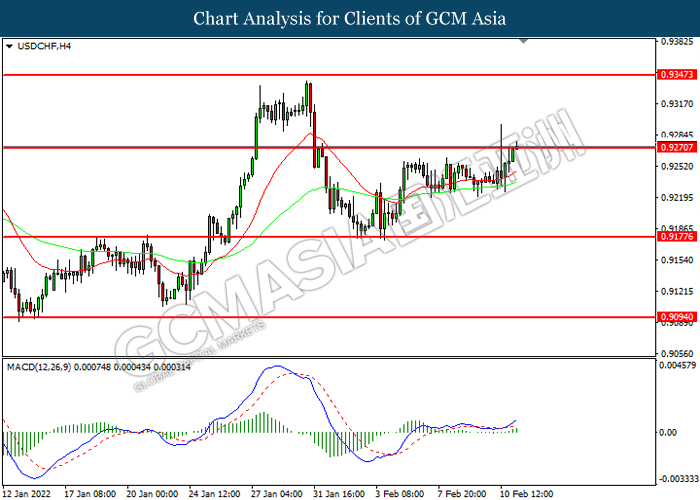

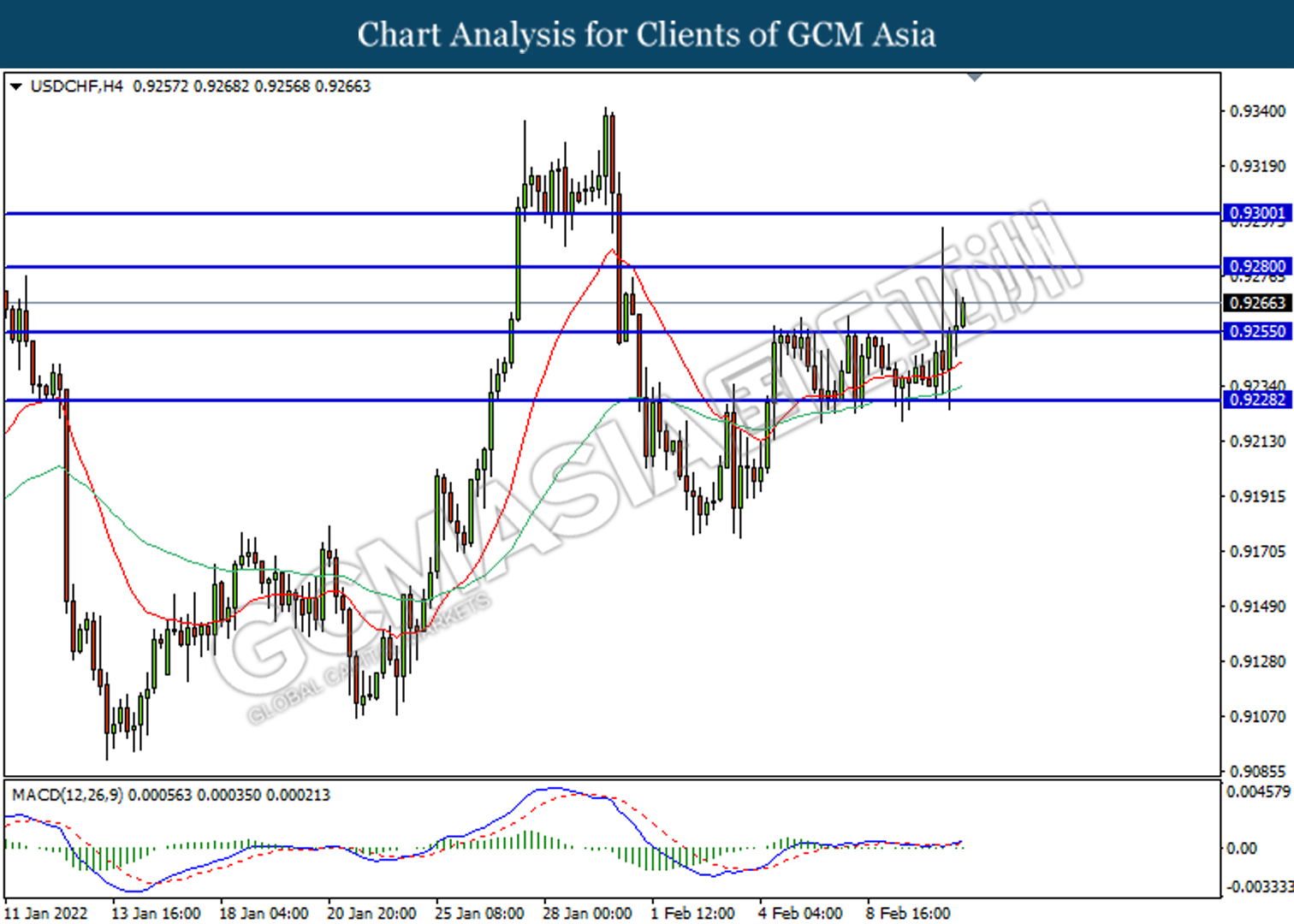

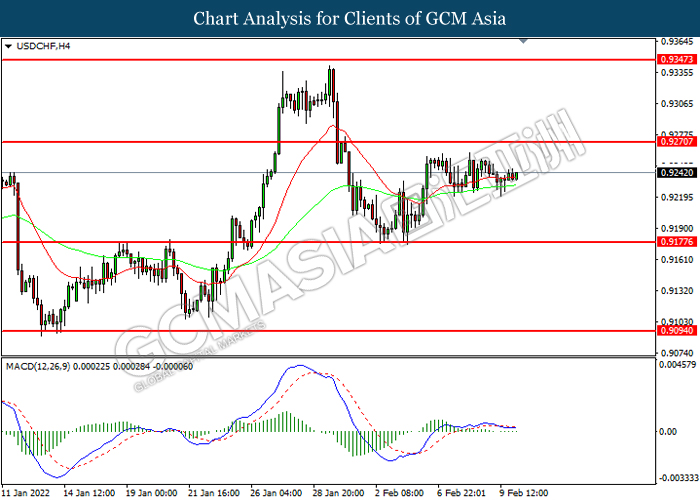

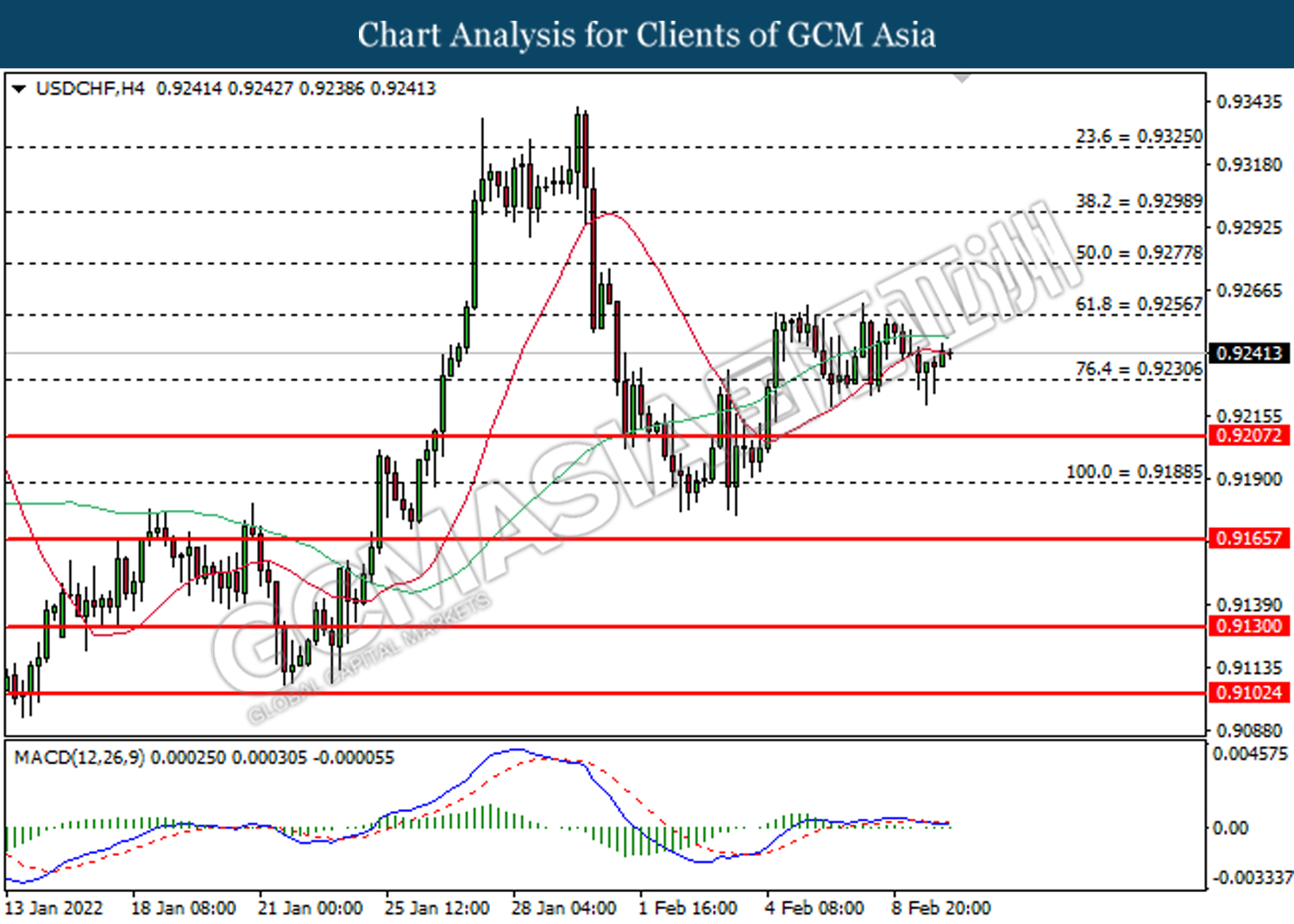

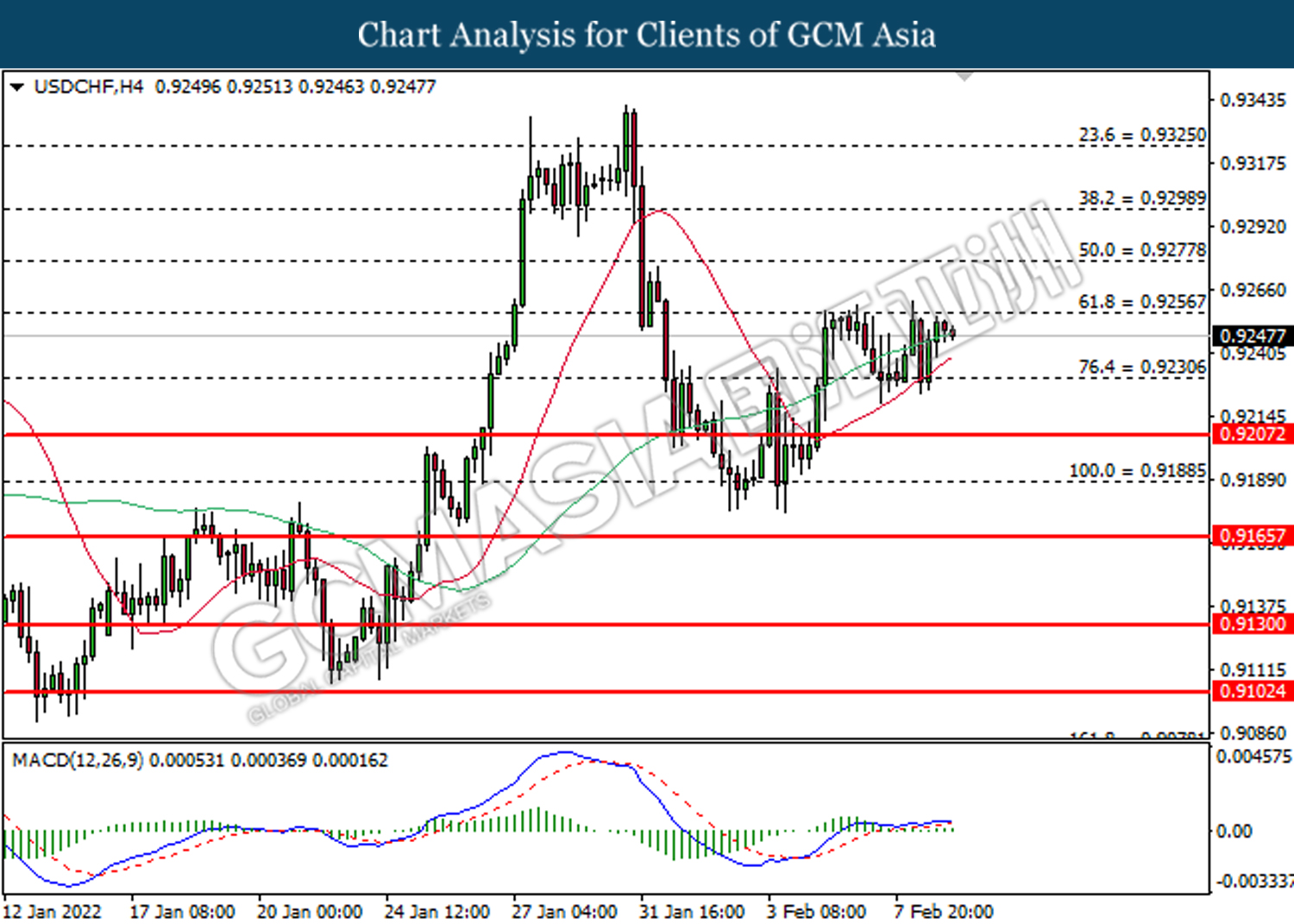

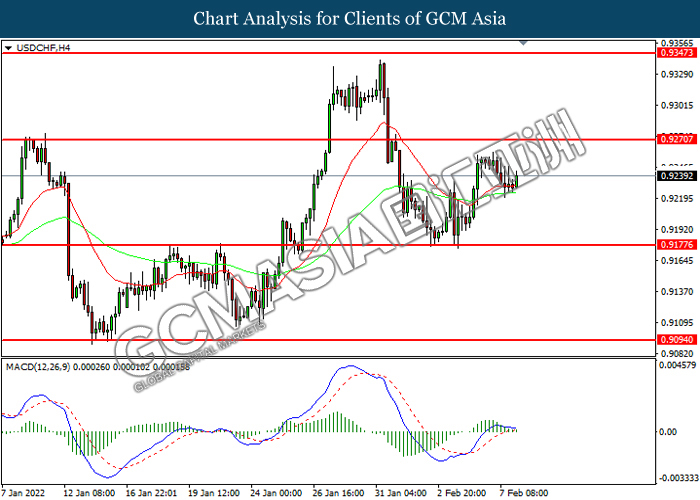

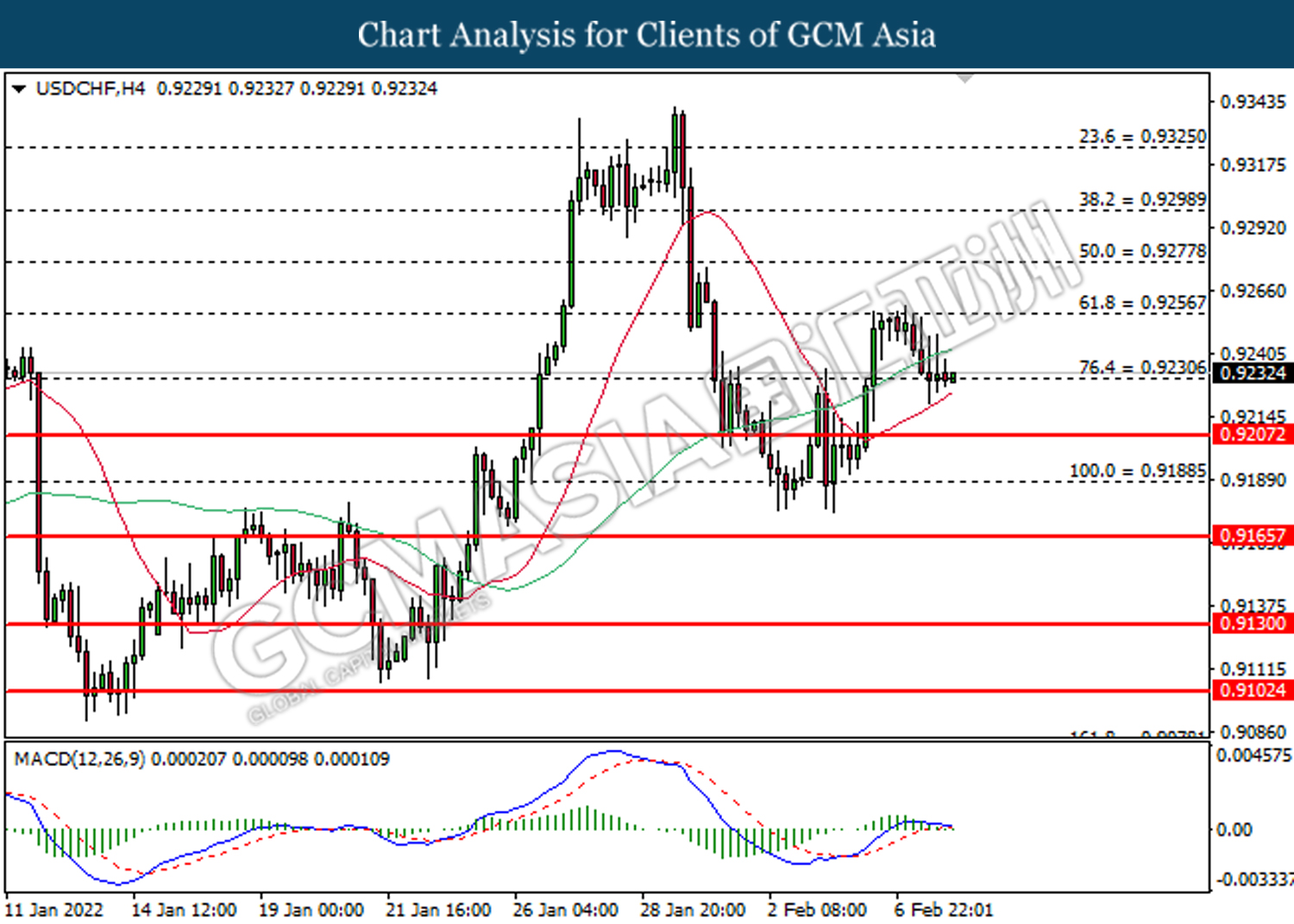

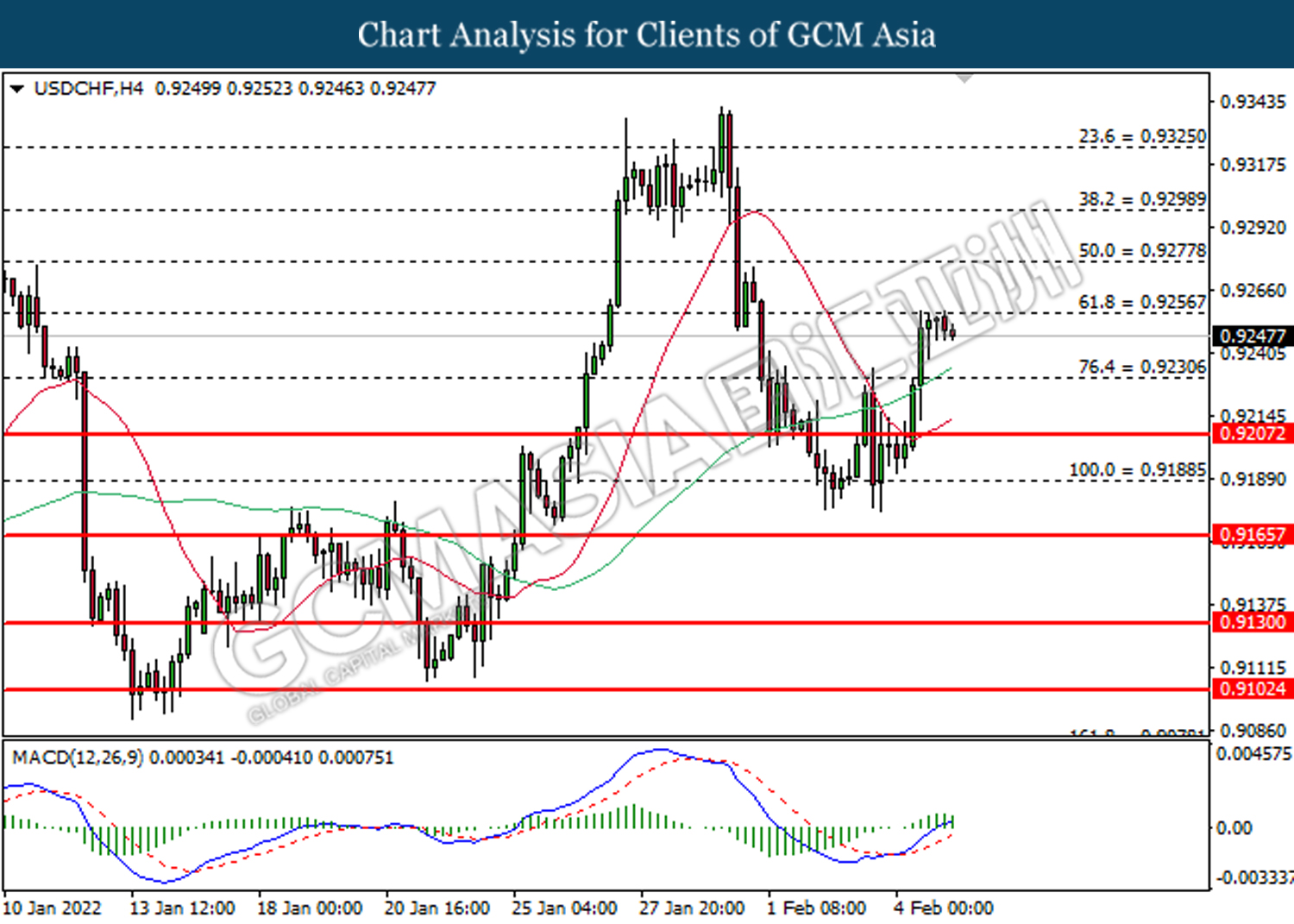

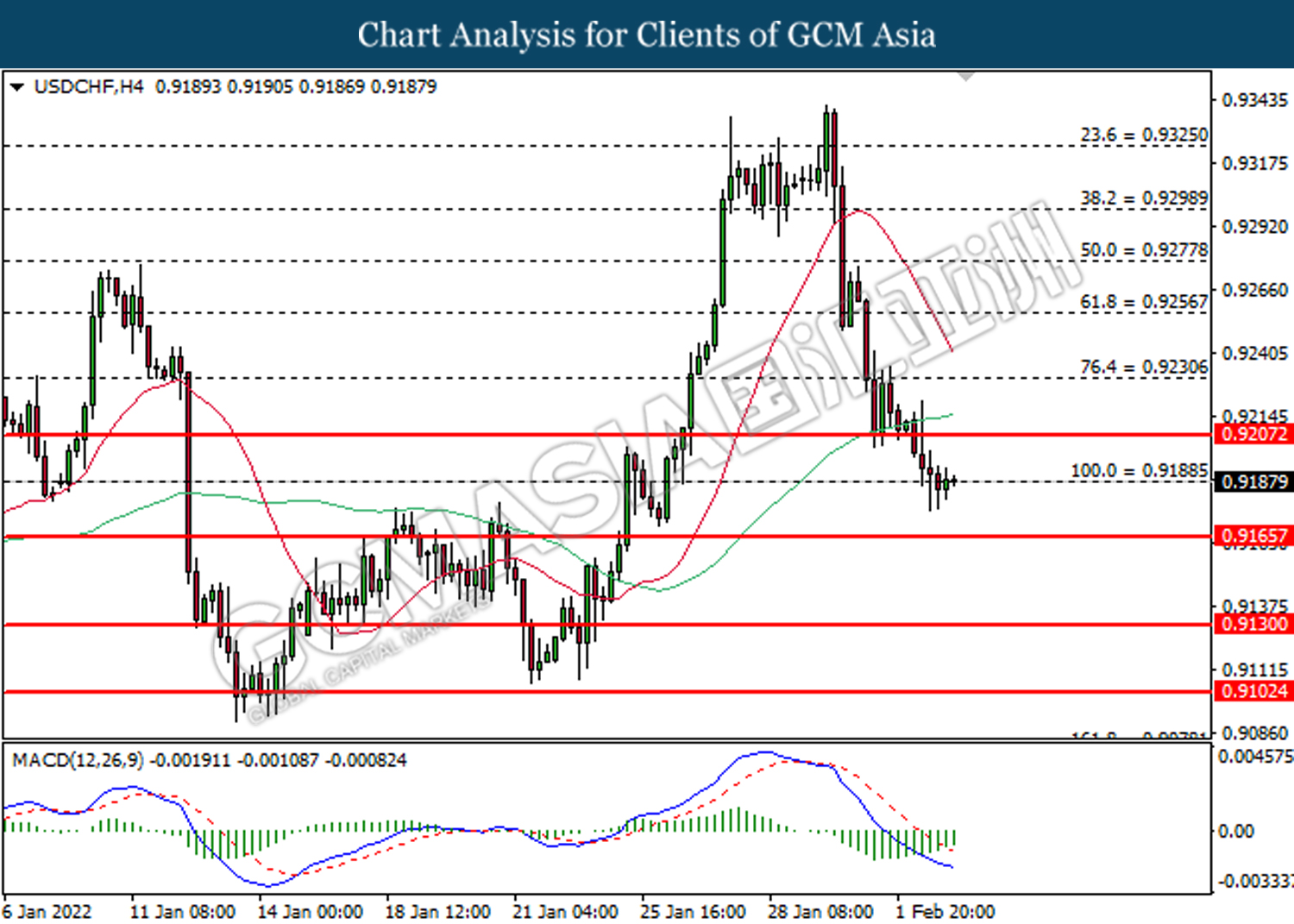

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

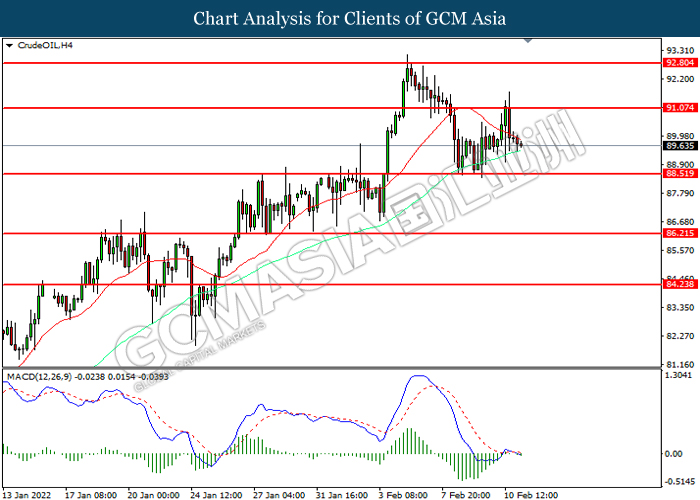

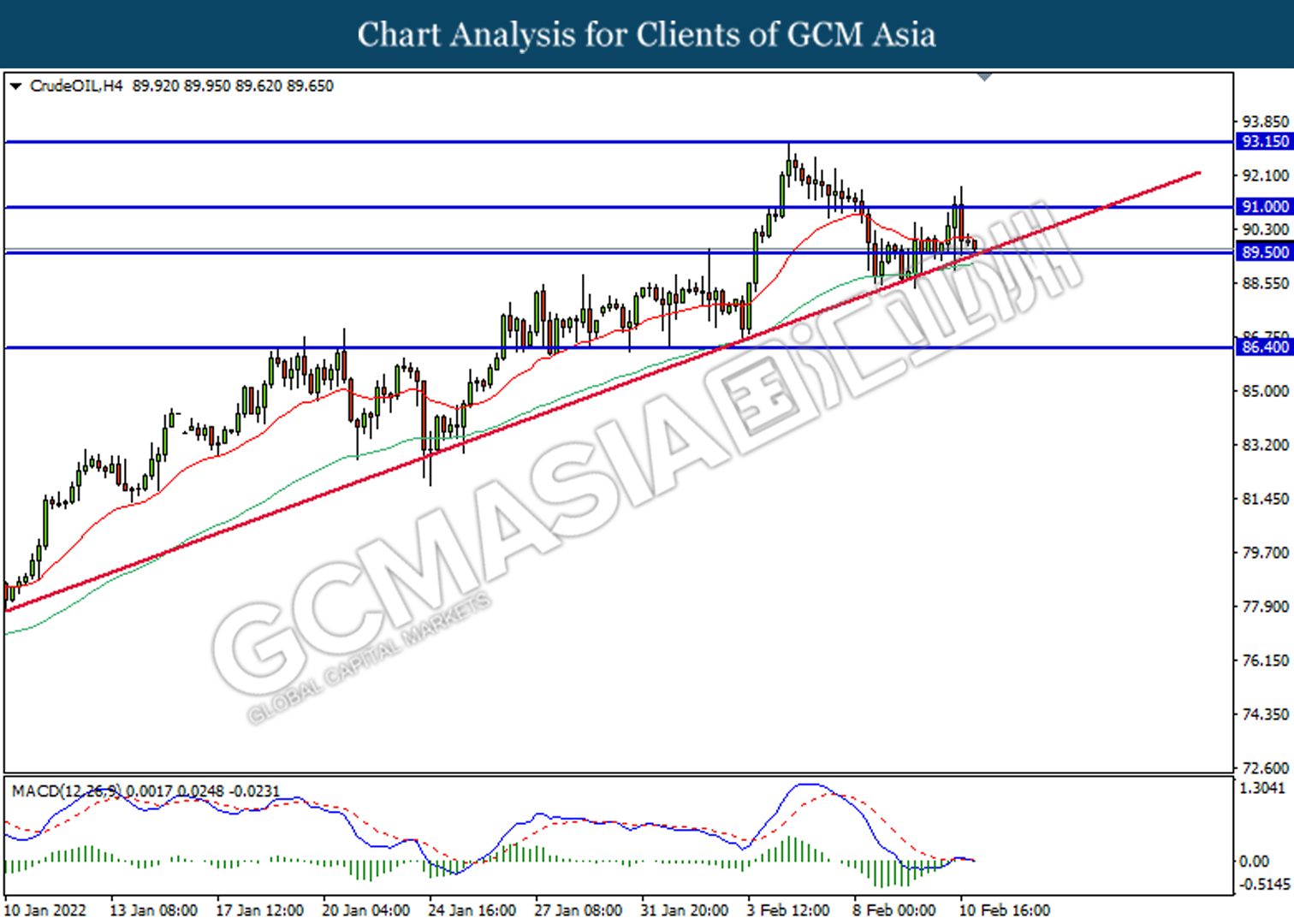

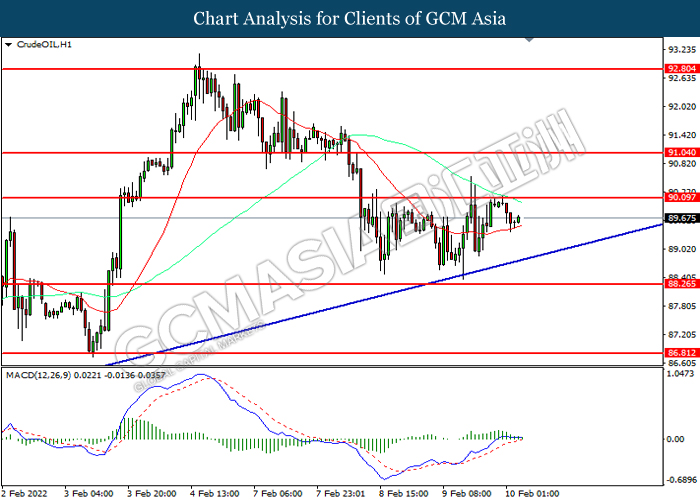

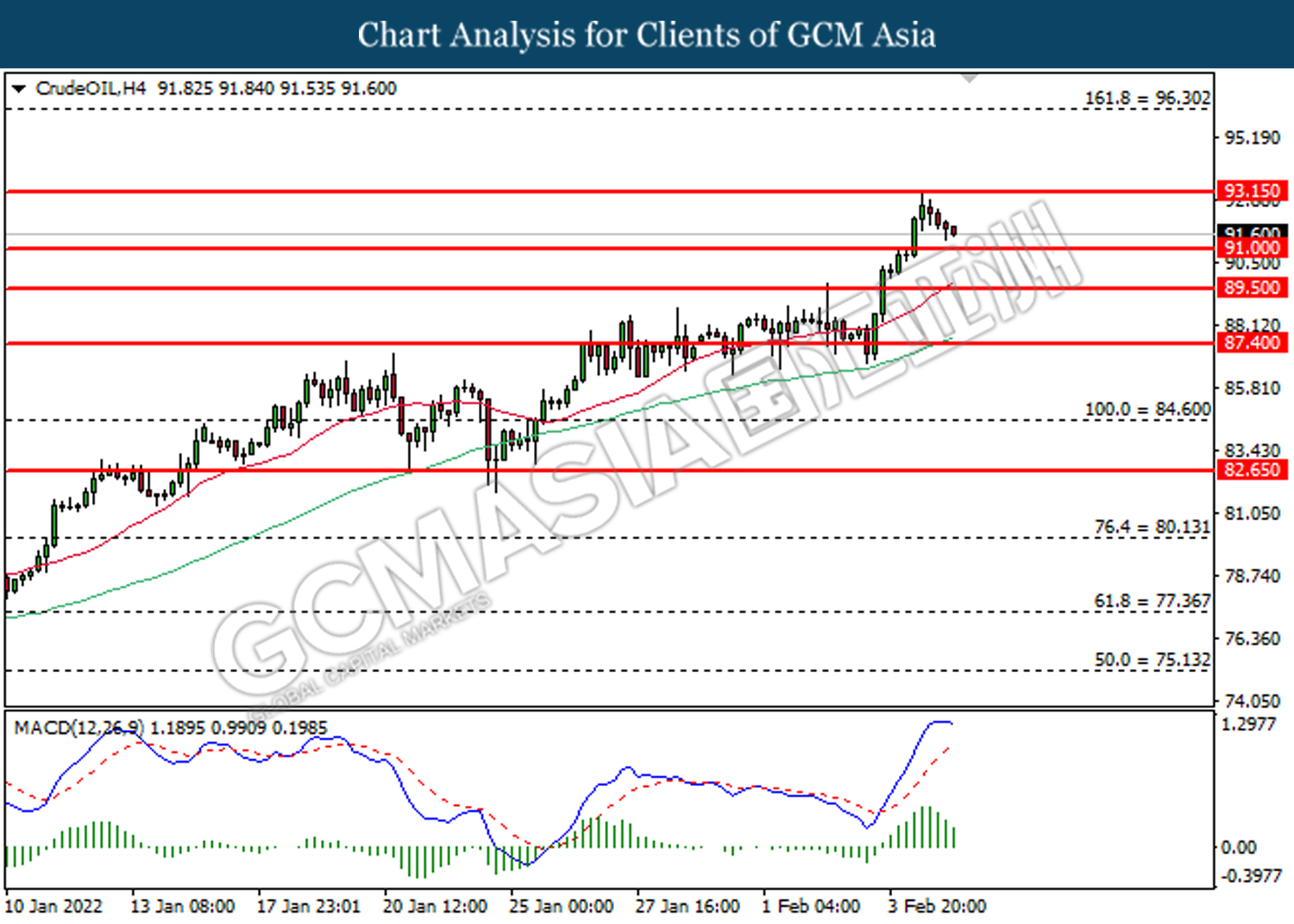

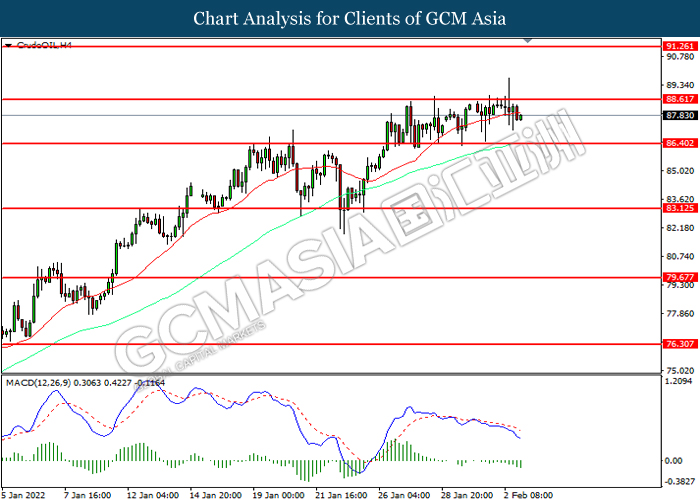

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 91.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 88.50.

Resistance level: 91.05, 92.80

Support level: 88.50, 86.20

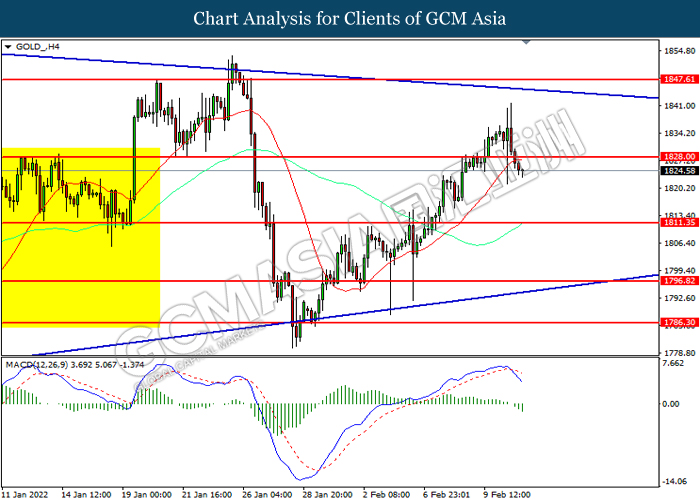

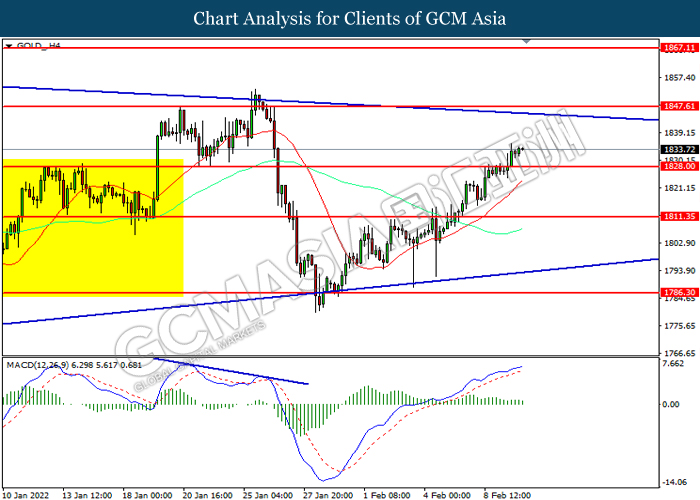

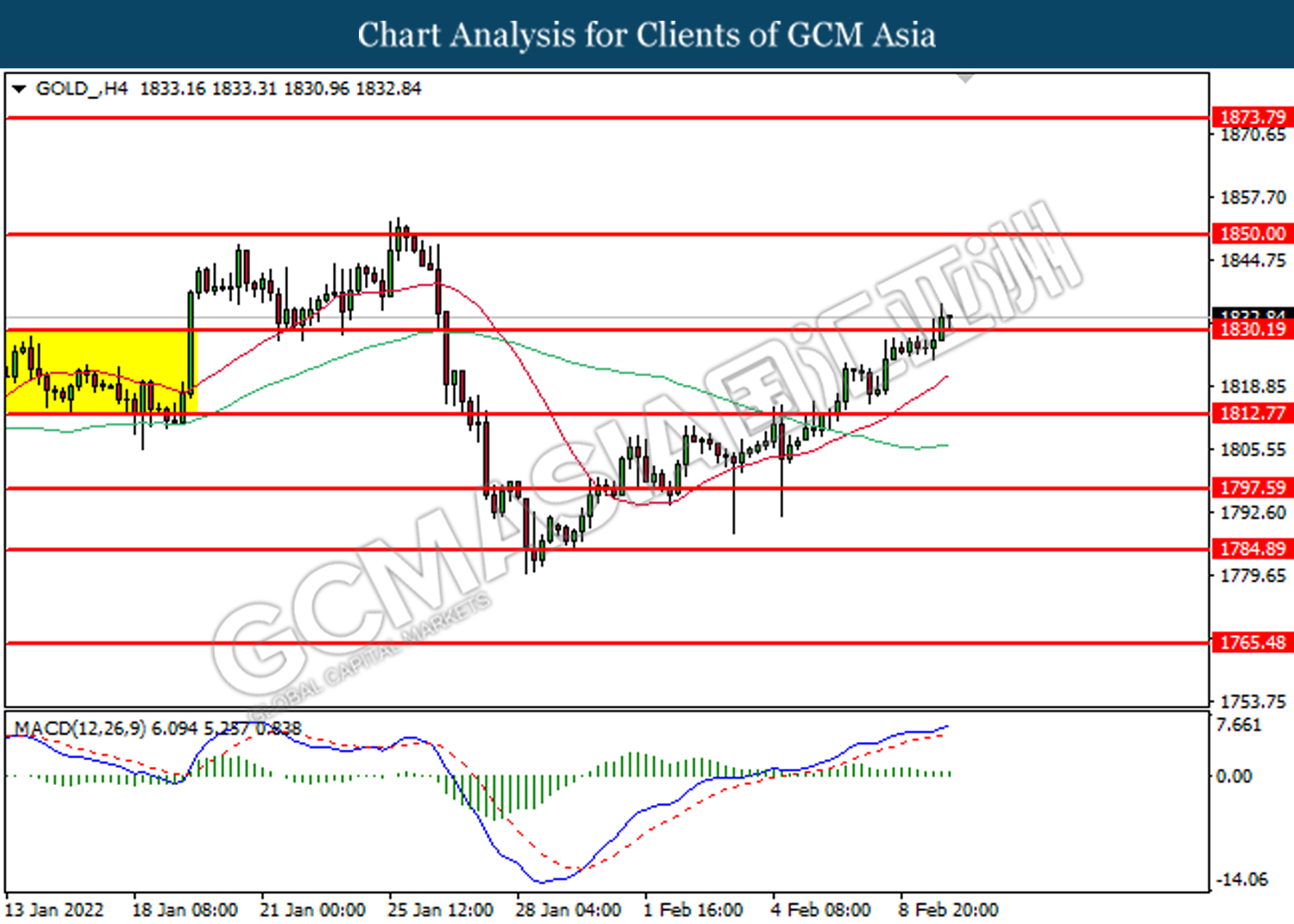

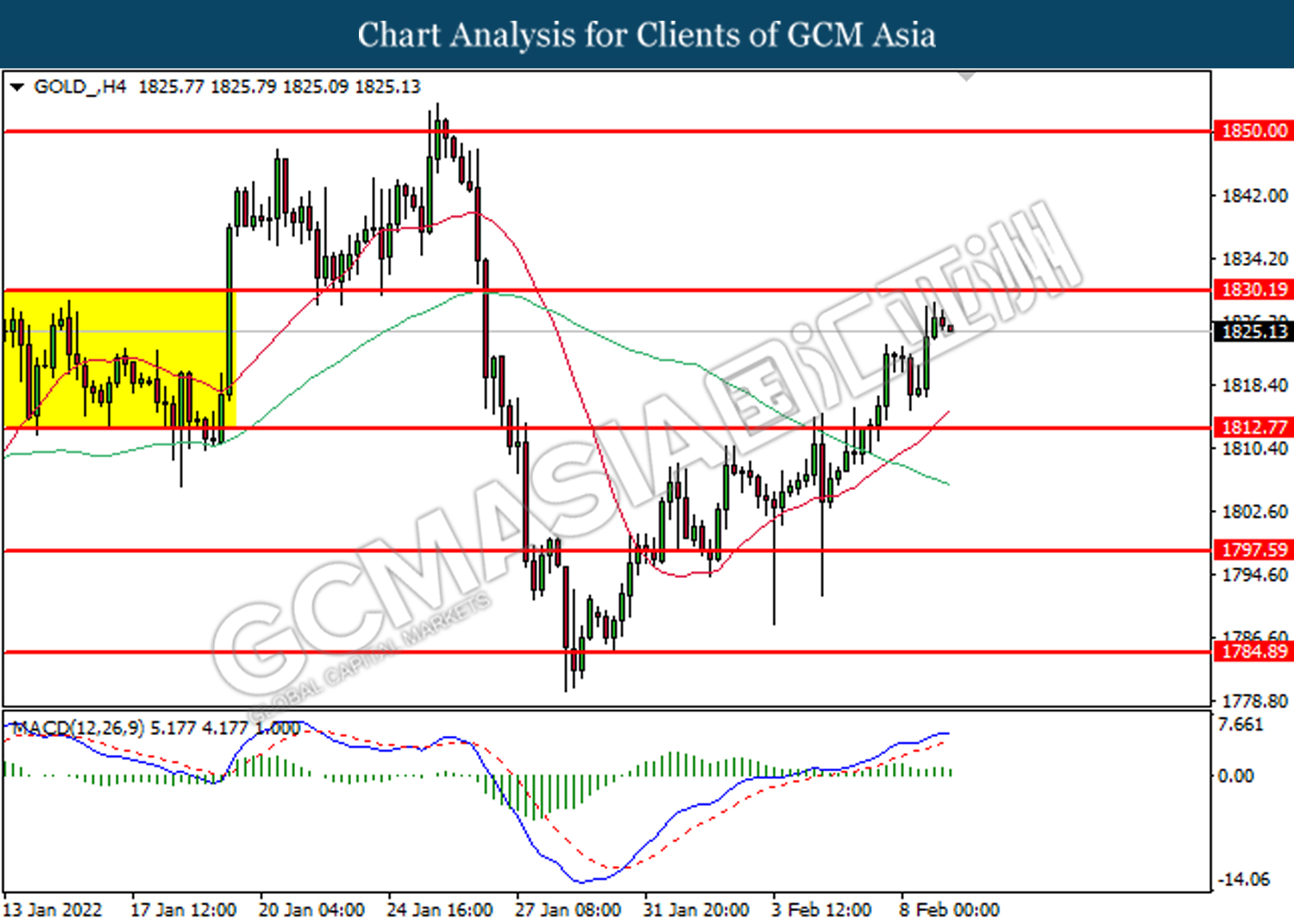

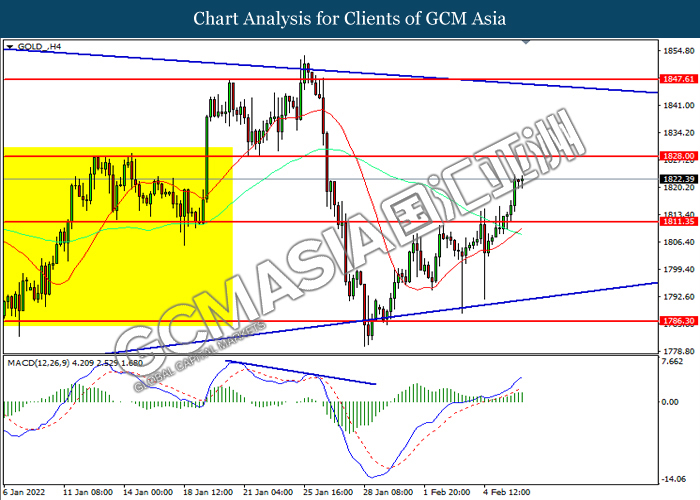

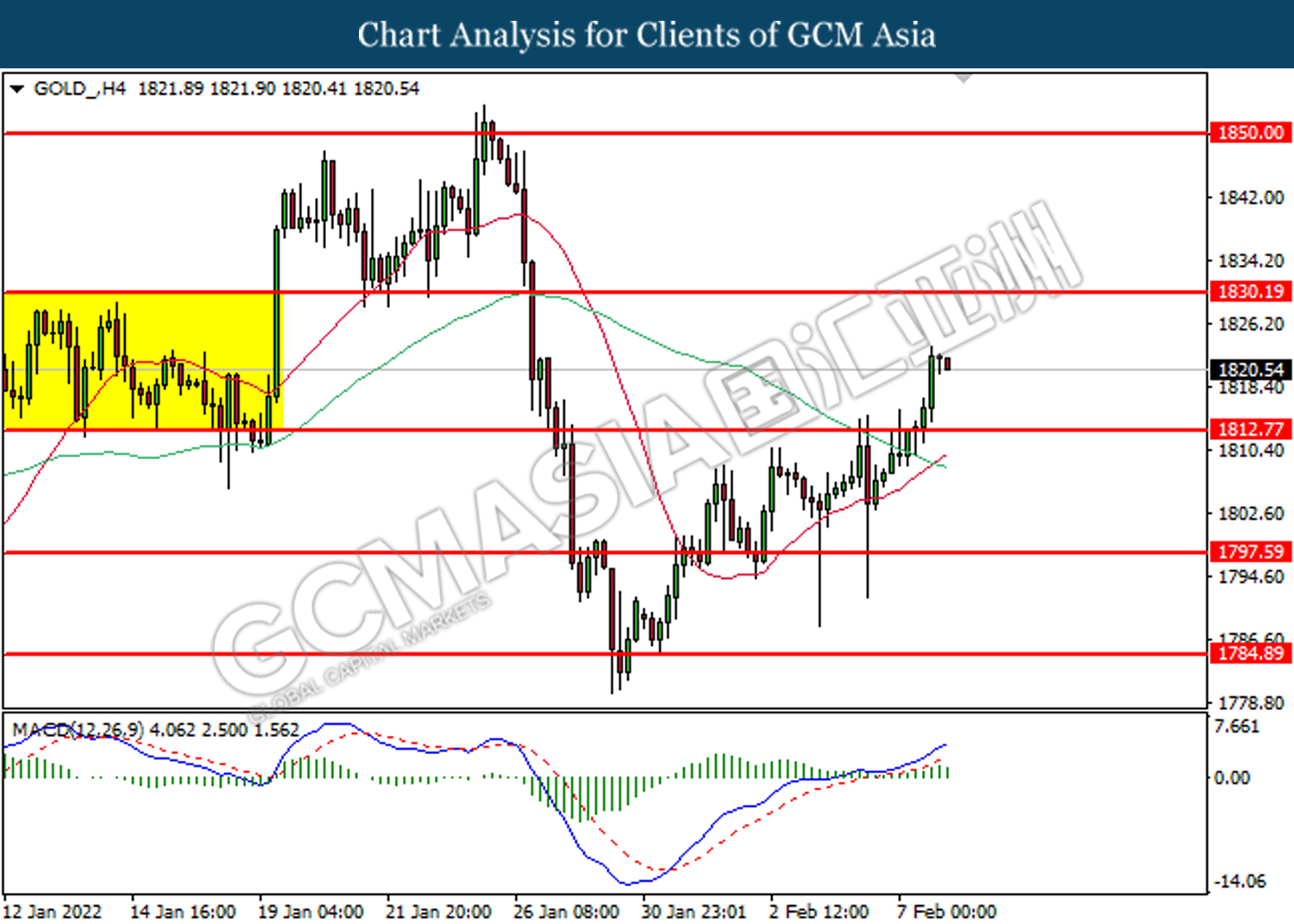

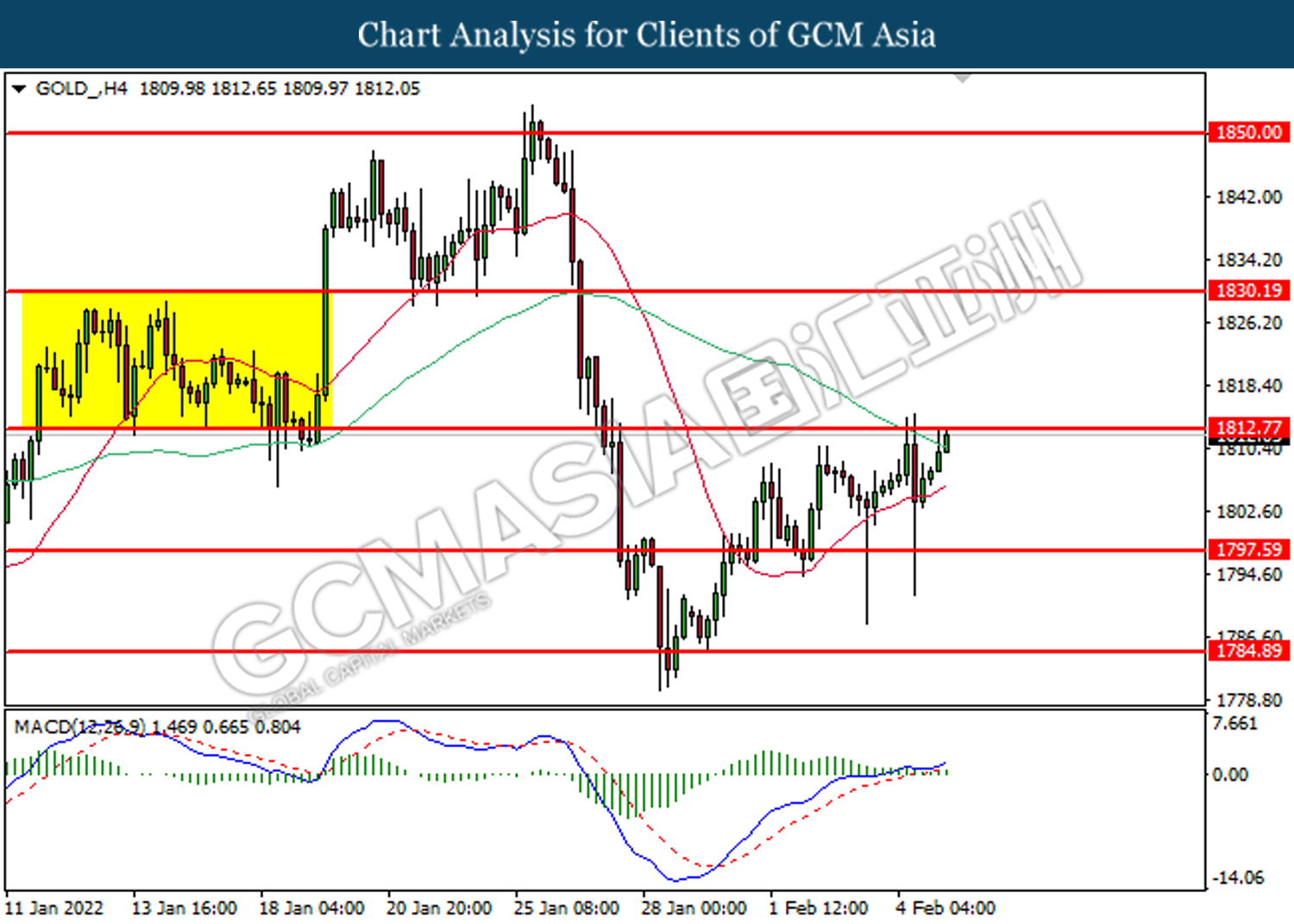

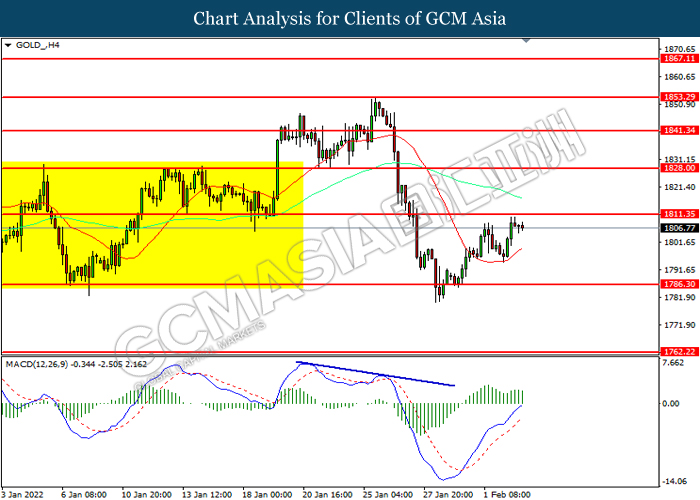

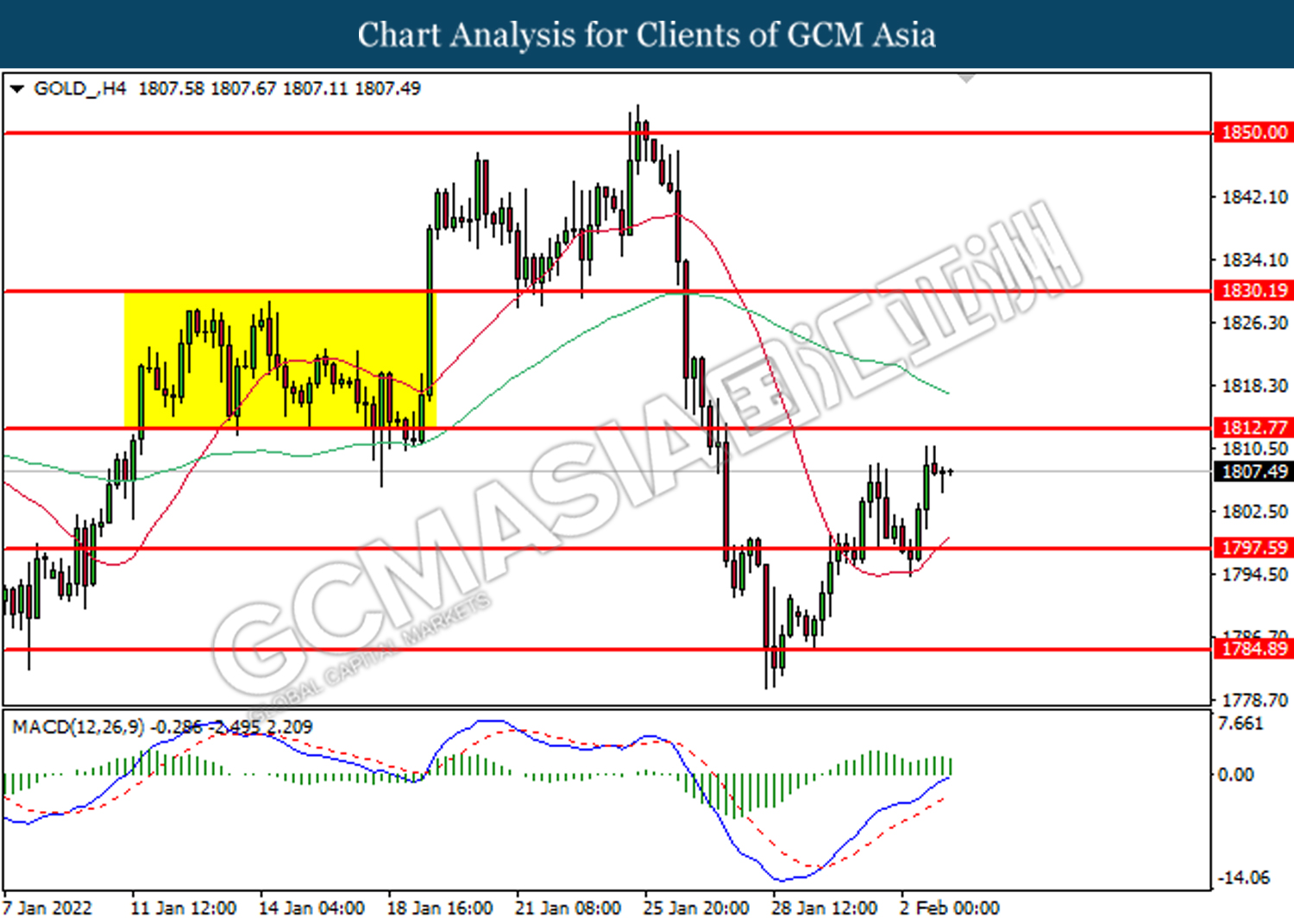

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1828.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1811.35.

Resistance level: 1828.00, 1847.60

Support level: 1811.35, 1796.80

110222 Morning Session Analysis

11 February 2022 Morning Session Analysis

Greenback surge over high inflation.

Greenback rebounds sharply from lower levels as high inflation in the United States spurs bullish speculation towards the Federal Reserve. According to US Labor Department, Core CPI for the month of January came in at 0.6%, slightly higher than consensus forecast of 0.5%. Price increase for last month was rather substantial due to higher costs for rents, electricity, and food. Following the data, Fed member James Bullard commented that the data has cemented the course to take a more hawkish approach in terms of monetary policy. When referring to CME FedWatch Tool, the probability for 50 basis point interest rate hike surge to 89.9%, significantly higher than the probability for 25 basis point interest rate hike with only 10.1%. For the time being, investors will wait for further signals from the US to gauge the trend direction of US dollar. As of writing, dollar index was up 0.01% to 95.61.

In the commodities market, crude oil price slumped 0.17% to $90.04 per barrel after reports shows an increase in Iran’s oil export despite ongoing sanctions. On the other hand, gold price was down 0.01% to $1,826.89 a troy ounce due to stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Monetary Policy Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GDP (YoY) (Q4) | 6.80% | 6.50% | – |

| 15:00 | Manufacturing Production (MoM) (Dec) | 1.10% | 0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after closing below the support level.

Resistance level: 1.1440, 1.1480

Support level: 1.1390, 1.1340

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after closing above the resistance level.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after closing below the support level.

Resistance level: 0.7180, 0.7230

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9280, 0.9300

Support level: 0.9255, 0.9230

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower after closing below the support level.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1830.00, 1850.00

Support level: 1812.80, 1797.60

100222 Afternoon Session Analysis

10 February 2022 Afternoon Session Analysis

Pound dived amid rising post-Brexit uncertainty.

The Pound Sterling slumped over the backdrop of rising political tensions between UK and Europe, which spurring negative prospect toward the economic momentum. According to CNBC, UK Prime Minister Boris Johnson told the EU that UK is ready and willing to unilaterally tear up post-Brexit borders rules in Northern Ireland unless both parties achieved consensus on talk. If EU still failed to compromise with UK, they will likely to trigger Article 16. Triggering Article 16 of the protocol would mean the UK deciding on its own to suspend border checks and increase the tariff for the European region. The UK and EU remain locked in talks amid they try to agree solution to smooth the operation of the protocol but a breakthrough remains elusive. As of writing, GBP/USD appreciated by 0.01% to 1.3535.

In the commodities market, the crude oil price dived 0.44% to $89.85 per barrel as of writing. The crude oil price extends its losses amid investors are closely speculating the outcome of US-Iran nuclear talks which resumed this week. A deal could lift US sanction on Iranian oil and increase the global oil supply. On the other hand, the gold price appreciated by 0.06% to $1834.40 per troy ounces as of writing amid rising inflation risk continue to increase the appeal for this safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 238K | 228K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.65. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.65, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7125. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7040

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 90.10. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 88.25.

Resistance level: 90.10, 91.05

Support level: 88.25, 86.80

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1828.00. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1847.60, 1867.10

Support level: 1828.00, 1811.35

100222 Morning Session Analysis

10 February 2022 Morning Session Analysis

CPI bounds to shake up greenback.

Greenback remains traded within a tight range as market participants waits for the release of Consumer Price Index data due later tonight. On yesterday, Washington has released a forecast report for inflation which has been presented during a live seminar. According to Economic Advisor Brian Deese, they expect inflationary pressure in the US to trend higher over mid-term with tomorrow’s data showing a higher year-over-year reading. The expectation was given based on rising service prices and wage growth that broadens current inflationary rate while high commodity prices such as crude oil will contribute to its rise for the near future. The forecast given on yesterday has sparked optimism among market participants, spurring higher demand for the US dollar prior to the release of the data. As of writing, dollar index was up 0.01% to 95.50.

In the commodities market, crude oil price was up 0.02% to $89.97 per barrel over the backdrop of a draw in US crude oil inventories for last week. On the other hand, gold price was up 0.01% to $1,832.66 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 238K | 228K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1440, 1.1480

Support level: 1.1390, 1.1340

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2595

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80

090222 Afternoon Session Analysis

09 February 2022 Afternoon Session Analysis

Australia Dollar surged amid risk-on mood.

The riskier asset such as the Australian Dollar rebounded significantly from lower level amid rising risk appetite in the global financial market following the positive development from Covid-19 pandemic, which spurring bullish momentum on the Australia Dollar. According to the World Health Organization, they officially claimed that the evidence is showing that the Omicron coronavirus variant is only affecting the upper respiratory tract, causing milder symptoms than previous variants while resulting in low death rates. Despite the case numbers due to Omicron variant have soared significantly across the world, some countries including United States have reduce the isolation or quarantine periods in a bid to allow people to return to work or school. As of writing, AUD/USD appreciated by 0.24% to 0.7162.

In the commodities market, the crude oil price depreciated by 0.32% to $89.75 per barrel as of writing. The oil price retraced from its higher level following the talks between United States and Iran resumed. Market participants speculated that Iran could increase more global oil supplies if both parties achieved consensus while United States removed the sanctions on Iran. On the other hand, the gold price appreciated by 0.14% to $1828.35 per troy ounces as of writing amid the global inflation risk continue to increase the appeal for the inflation-hedged commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.046M | 0.369M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1380.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.40, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7205.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7040

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 92.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 88.55.

Resistance level: 92.80, 100.15

Support level: 84.25, 75.00

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1828.00. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1828.00, 1847.60

Support level: 1786.30, 1762.20

090222 Morning Session Analysis

9 February 2022 Morning Session Analysis

ECB thwarts Euro hawks.

Euro was sold substantially on yesterday night following dovish stance given by European Central Bank (ECB). On yesterday, ECB President Christine Lagarde stated that high inflation rate in the EU is more likely to diminish in the mid-term and stabilizes near their targeted range of 2%. The comment was given following assessment upon current economic condition which does not provide any further signals that supports for a persistently high inflationary pressure in the near future. In addition, Lagarde commented that EU’s current inflation rate is well under control while slight tightening in monetary policy may be required in the mid-term to bring it back closer to their targeted range. Lagarde’s latest statement contradicts with last week’s policy meeting signals which suggests for a faster pace of tightening with possibility of a rate hike at the end of the year. As of writing, EUR/USD was down 0.03% to 1.1414.

In the commodities market, crude oil price was up 0.05% to $89.73 per barrel after American Petroleum Institute reported a draw in oil inventories last week by 1.1 million barrels. On the other hand, gold price ticks up 0.01% to $1,825.97 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.046M | 0.369M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.1440, 1.1480

Support level: 1.1390, 1.1340

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2765, 1.2835

Support level: 1.2690, 1.2620

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60

080222 Afternoon Session Analysis

08 February 2022 Afternoon Session Analysis

Euro Maintains Its Strong Rally.

Euro extended into correction after strong rally from strong data released from US nonfarm payrolls last week. Nonetheless, Euro is still maintaining its bullish position in overall after Italy’s 10-year bond yields rose 23 basis points to 1.64%, highest since May 2020, as well as Germany’s 10-year bond yields jumped 12 basis points to 0.15%, the highest since 2019. With this, investors have higher confidence in riskier securities, thereby speeding up the decision for a rate hike. Furthermore, ECB President Christine Lagarde’s unexpected hawkish statement along with the pressure of inflation and treasury yields increase strengthened the expectations for a rate hike which causes the Euro to consolidate at the upper level. Nonetheless, market participants will be monitoring updates on CPI data and US monetary policy statement in order to gauge the potential movement on the pair. As of writing, EURUSD dropped to 1.1429.

For the commodities market, crude oil prices were down by 0.2% to $91.20 per barrel, signaling a correction after a strong spike due to supply shortage. On the other hand, gold price was up by 0.03% to $1822.40 per troy ounce due to weaker US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1380.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1200

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.35, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7125, 0.7205

Support level: 0.7040, 0.7000

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6535. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 92.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 88.55.

Resistance level: 92.80, 97.75

Support level: 88.55, 84.25

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1828.00. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1828.00, 1847.60

Support level: 1811.35, 1786.30

080222 Morning Session Analysis

8 February 2022 Morning Session Analysis

Investors waits for US CPI data.

Greenback was traded flat during Asian trading session as investors waits for the release of Consumer Price Index data due this Thursday. Previously, US dollar received a substantial rebound from lower levels after Nonfarm Payrolls came in higher than expected. The data has cemented investors expectation towards Federal Reserve to tighten monetary policy at a faster pace in order to curb rising inflation in the region. During last policy meeting, Fed Chair Jerome Powell commented that there are enough room to initiate subsequent rate hikes if inflation persists at higher levels. According to CME FedWatch Tool, investors are currently pricing in at a 100% chance for an interest rate hike during March policy meeting. As of writing, the dollar index was up 0.01% to 95.35.

In the commodities market, crude oil price was down 0.04% to $91.39 per barrel following possibility of revived talks in between US and Iran with regards to nuclear agreement. On the other hand, gold price was up 0.01% to $1,821.40 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 1.1480, 1.1535

Support level: 1.1440, 1.1390

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60

070222 Afternoon Session Analysis

07 February 2022 Afternoon Session Analysis

Rate hike expectation, insinuate demand for Euro.

The overall trend for the Euro remained bullish following the European Central Bank (ECB)’s governing council unleashed their hawkish tone toward the economic momentum in the European region. According to Reuters, Klass Knot claimed on Sunday that he expects the European Central Bank (ECB) would initiate a rate hike in the fourth quarter of this year in order to combat the high inflation risk. Earlier, the Eurozone inflation rate hit record levels for third month in a row, jeopardizing the growth in consumer spending while spurring the odds for the ECB to implement contractionary monetary policy. Market participants will continue to observe if there is any shift in the European Central Bank’s outlook to receive further trading signal. As of writing, EUR/USD surged 0.03% to 1.1440.

In the commodities market, the crude oil price depreciated by 0.38% to $92.00 per barrel as of writing amid technical correction following a run of seven consecutive weekly gains. Nonetheless, the overall trend for the oil market remained bullish amid tight supply disruption fears due to the massive winter storm across the United States continue to spur bullish momentum for this black-commodity. On the other hand, the gold price depreciated by 0.05% to $1809.70 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.1380.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1200

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.35. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.35, 116.25

Support level: 112.85, 110.90

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7040. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7040.

Resistance level: 0.7125, 0.7205

Support level: 0.7040, 0.7000

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6710. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6710, 0.6865

Support level: 0.6550, 0.6430

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2625. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 92.40. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 92.40, 97.75

Support level: 88.55, 84.25

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1811.35. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1811.35, 1828.00

Support level: 1786.30, 1762.20

070222 Morning Session Analysis

7 February 2022 Morning Session Analysis

Nonfarm Payrolls out of expectation.

Greenback rebounds slightly on last Friday as investors digest better-than-expected Nonfarm Payrolls report for last month. According to Bureau of Labor Statistics, Nonfarm Payrolls came in at 467K for the month of January, significantly higher than forecast of 150K. Previously, investors speculated Nonfarm Payrolls report to shows significant job losses as ADP Nonfarm Employment Change came in with a negative reading. The data shows that US jobs market remains resilient despite rising Omicron cases throughout the country during last month. In addition, US Average Hourly Earnings rose by 0.7% for last month. The data has cemented the course for further monetary policy tightening from Federal Reserve in order to prevent spillover effect upon inflation. As of writing, the dollar index was up 0.02% to 95.40.

As for commodities, crude oil price slumped by 0.52% to $91.74 per barrel due to technical correction from higher levels. On the other hand, gold price rose 0.13% to $1,810.04 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 1.1480, 1.1535

Support level: 1.1440, 1.1390

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7100, 0.7140

Support level: 0.7055, 0.6980

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2765, 1.2835

Support level: 1.2690, 1.2620

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1812.80, 1830.20

Support level: 1797.60, 1784.90

040222 Afternoon Session Analysis

04 February 2022 Afternoon Session Analysis

Hawkish tone from ECB increased the appeal of Euro.

The Euro received significant bullish momentum over the backdrop of hawkish tone from the European Central Bank. Yesterday, the ECB finally acknowledged mounting inflation risk would be lasted in long-term basis and signaling the possibility of rate hike this year. According to Reuters, the Monetary Policy Committee (MPC) were clear that a rate hiked this year should no longer be excluded given the spiking inflation risks in future. Nonetheless, the European Central Bank opted to maintain the deposit rate unchanged at -0.50%, aligned with market expectation at -0.50% while earlier aggressive bond buying program PEPP will be ended in March. Though, as for now investors would continue to scrutinize the crucial updates with regards of the economic data to gauge the likelihood movement for the pair of EUR/USD. As of writing, EUR/USD appreciated by 0.23% to 1.1465.

In the commodities market, the crude oil price appreciated by 0.76% to $91.25 per barrel as of writing. The oil market extends its gains amid the massive winter storm across the central and Northeast United States on Thursday was threatening to further disrupt oil supplies in future, spurring bullish momentum on this black-commodity. On the other hand, the gold price surged 0.07% to $1806.20 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Jan) | 54.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 199K | 150K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.90% | 3.90% | – |

| 21:30 | CAD – Employment Change (Jan) | 54.7K | -117.5K | – |

| 23:00 | CAD – Ivey PMI (Jan) | 45 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3595. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, Daily: EURUSD was traded higher following breakout above the previous resistance level at 1.1380. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1525.

Resistance level: 1.1525, 1.1680

Support level: 1.1380, 1.1200

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 114.95. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 113.65.

Resistance level: 114.95, 115.65

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7125. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7065

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6550. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6550, 0.6430

USDCAD, Daily: USDCAD was traded lower while currently near the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9180. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 92.40. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 92.40, 99.65

Support level: 84.25, 75.00

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1811.35. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1811.35, 1828.00

Support level: 1786.30, 1762.20

040222 Morning Session Analysis

4 February 2022 Morning Session Analysis

BoE hike rates as inflation rises.

Pound sterling rebounds sharply from lower level after Bank of England delivers a rather hawkish decision during its monetary policy meeting. On yesterday, BoE initiated a 25-basis points rate hike from 0.25% to 0.50%. The decision was announced after UK government introduced a 9 billion pound sterling program which is aimed to help reduces burden from rising cost of electric in the UK. During press conference, BoE Governor Andrew Bailey stated that rising cost of commodity especially natural gas and crude oil is the main factor that drives inflation higher. Bailey also emphasized that strong economic recovery coupled with disruption upon supply chain as well as lack of raw materials contributes to rising cost of consumer products. At the same time, BoE also announced to start unwinding its 895 billion pound sterling of quantitative easing program in order to help curb rising inflation along side with interest rate hike. As of writing, pair of GBP/USD rose 0.05% to 1.3597.

In the commodities market, crude oil price rose 0.04% to $90.17 per barrel following oil supply disruption in Libya and Nigeria which may worsen global supply deficit. On the other hand, gold price was up 0.01% to $1,805.19 a troy ounce due to weaker greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Jan) | 54.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 199K | 150K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.90% | 3.90% | – |

| 21:30 | CAD – Employment Change (Jan) | 54.7K | -117.5K | – |

| 23:00 | CAD – Ivey PMI (Jan) | 45 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.1440, 1.1475

Support level: 1.1390, 1.1340

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. However, MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1812.80, 1830.20

Support level: 1797.60, 1784.90

030222 Afternoon Session Analysis

03 February 2022 Afternoon Session Analysis

Euro surged amid spiking inflation reading.

The Euro surged over the backdrop of bullish economic data yesterday, spurring hopes for the European Central Bank to unleash their hawkish tone during the monetary policy meeting. According to Eurostat, Eurozone Consumer Price Index (CPI) notched up from the previous reading of 5.0% to 5.1%, exceeding the market forecast at 4.4%. The high inflation rate increases the odds for the ECB to increase their interest rates at 30 basis point by the end of the year, despite ECB insisted that any rate change is very unlikely. Contractionary monetary policy and rate hike will diminish the money circulation in the global financial market, spurring bullish momentum for the Euro. Nonetheless, market participants predicted that the ECB are almost certain to keep the policy unchanged, though they would still continue to scrutinize the latest updates with regards of the monetary policy statement to receive further trading signal. As of writing, EUR/USD appreciated by 0.03% to 1.1300.

In the commodities market, the crude oil price surged 0.05% to $88.45 per barrel as of writing. The crude oil price edged higher over the backdrop of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories notched down from the previous reading of 2.377M to -1.046M, better than the market forecast at 1.525M. On the other hand, the gold price surged 0.02% to $1806.70 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Inflation Report

20:00 GBP BoE MPC Meeting Minutes

20:45 EUR ECB Monetary Policy Statement

21:30 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Services PMI | 53.6 | 53.3 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Feb) | 0.25% | 0.50% | – |

| 20:45 | EUR – ECB Interest Rate Decision | 0.00% | 0.00% | – |

| 21:30 | USD – Initial Jobless Claims | 260K | 245K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 62 | 59.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 95.95. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3595. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1200. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1380, 1.1470

Support level: 1.1200, 1.1120

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 114.95. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 114.95, 115.65

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7125. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7065

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6550. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6550, 0.6430

USDCAD, Daily: USDCAD was traded lower while currently near the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9180. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 88.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 86.40.

Resistance level: 88.60, 91.25

Support level: 86.40, 83.15

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1811.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1811.35, 1828.00

Support level: 1786.30, 1762.20

030222 Morning Session Analysis

3 February 2022 Morning Session Analysis

ADP slumps as Omicron spreads.

Greenback extended its retracement from higher levels following the release of private sector employment data. Last month, ADP Nonfarm Employment Change decreased by -301,000, significantly lower than forecast of 207,000. Job losses were noticeable across all sector and most prominent in the services sector. The report highlighted the impact of Omicron variant which begins to spread rapidly during late of December 2021. However, economists expect negative impact from Omicron to persist in the short-term and employment market may rebound in the mid-term. Likewise, market reaction towards the data were limited due as Federal Reserve is expected to raise interest rates regardless in order to curb rising inflation in the US. As of writing, the dollar index was down by 0.02% to 95.93.

For the commodities market, crude oil price was down by 0.59% to $87.80 per barrel after Saudi Arabia and Kuwait announce plans to raise oil output in the Neutral Zone. On the other hand, gold price was up by 0.02% to $1,807.10 a troy ounce due to weaker greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Inflation Report

20:00 GBP BoE MPC Meeting Minutes

20:45 EUR ECB Monetary Policy Statement

21:30 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Services PMI | 53.6 | 53.3 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Feb) | 0.25% | 0.50% | – |

| 20:45 | EUR – ECB Interest Rate Decision | 0.00% | 0.00% | – |

| 21:30 | USD – Initial Jobless Claims | 260K | 245K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 62 | 59.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower after breaking its support level.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded lower following prior retrace from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.55, 115.50

Support level: 113.50, 112.75

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6635, 0.6670

Support level: 0.6695, 0.6560

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher after breaking its resistance level

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. However, MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded higher in short-term.

Resistance level: 89.50, 91.00

Support level: 87.40, 84.60

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1812.80, 1830.20

Support level: 1797.60, 1784.90

280122 Afternoon Session Analysis

28 January 2022 Afternoon Session Analysis

Fed hawkish expectation continue to weigh down the pair of NZD/USD.

The pair of NZD/USD remained bearish despite upbeat economic data from the New Zealand region, amid the hawkish expectation from the Federal Reserve continue to spark the market demand on US Dollar. According to Statistics New Zealand, New Zealand Consumer Price Index (CPI) came in at 1.4%, exceeding the market forecast at 1.3%. The economic momentum for New Zealand remained strong due to strong consumer spending following the Covid-19 cases eased. Such high reading had increased the odds for the Reserve Bank of New Zealand (RBNZ) to take further steps in order to curb rising living costs. On the other hand, the US Dollar surged over the hawkish expectation from Federal Reserve following the US unleashed upbeat GDP data. As of writing, NZD/USD depreciated by 0.02% to 0.6575.

In the commodities market, the crude oil price depreciated by 0.30% to $87.50 per barrel as of writing amid technical correction following it reached recent high. Nonetheless, the overall trend for the crude oil remained bullish amid concerns of supply disruption following the rising tensions between Russia and Ukraine. On the other hand, the gold price surged 0.10% to $1799.00 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German GDP (QoQ) (Q4) | 1.70% | -0.20% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 97.60, 98.35

Support level: 96.80, 95.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3445, 1.3495

Support level: 1.3355, 1.3280

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1195, 1.1275

Support level: 1.1110, 1.1020

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.40, 116.20

Support level: 114.50, 113.35

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7115, 0.7275

Support level: 0.7000, 0.6865

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6690, 0.6830

Support level: 0.6530, 0.6385

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.2755, 1.2825

Support level: 1.2685, 1.2580

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9305. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9305, 0.9375

Support level: 0.9215, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 88.20, 90.90

Support level: 86.30, 84.80

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1811.20. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1811.20, 1831.70

Support level: 1785.00, 1765.00