190523 Afternoon Session Analysis

19 May 2023 Afternoon Session Analysis

The kiwi corrective bounce despite mixed economic data.

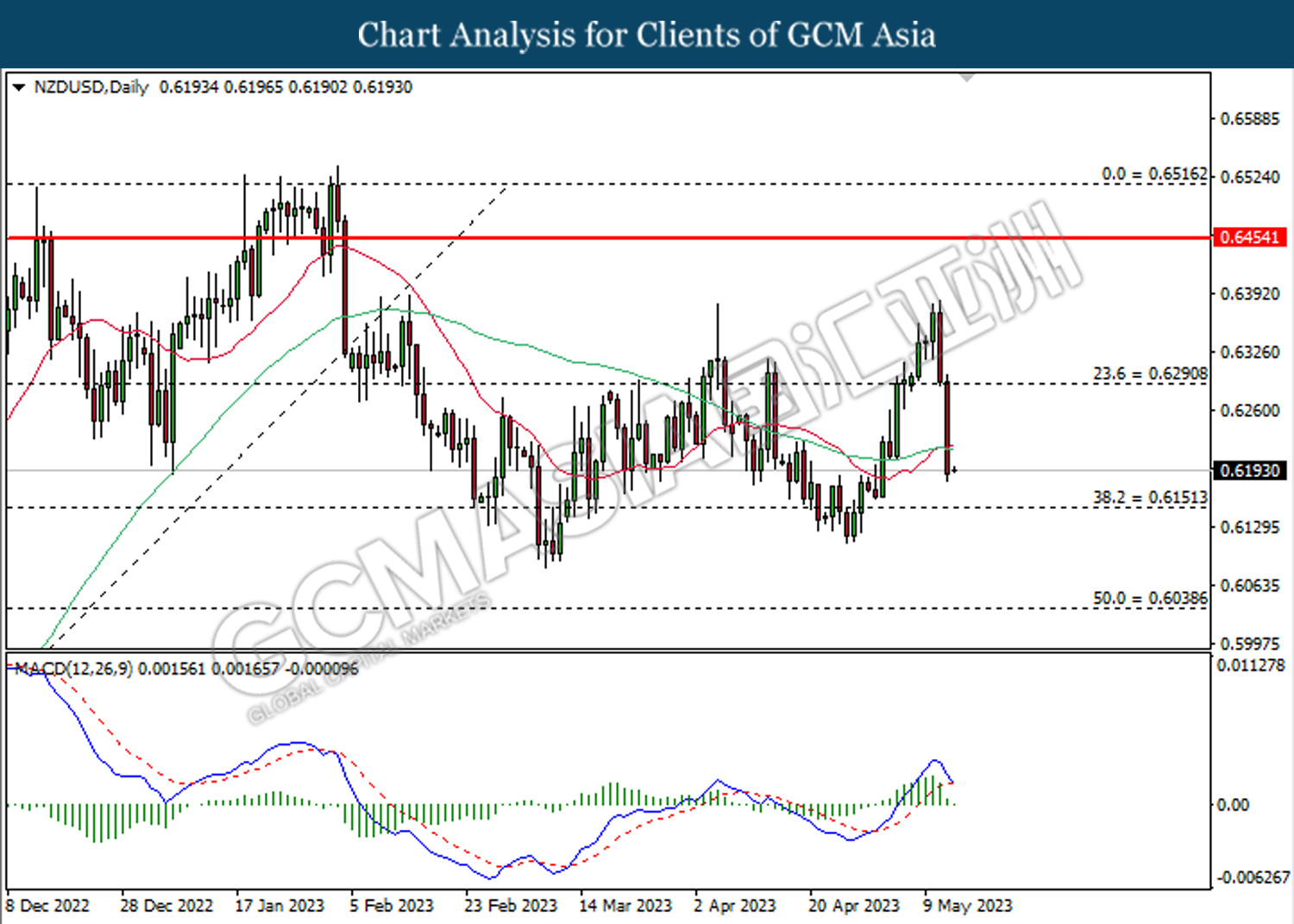

The Kiwi index, which was traded against the greenback, revise its trend after the mixed economic data released recently. The April Trade Balance data infused some strength in the New Zealand dollar as the monthly trade balance improved to $427 million from $-1586 million in monthly reading, higher than the market expectation of -235M. However, the number in the annual reading eased to -16.8B versus -17.08B slightly lower than the prior reading. The monthly trade export rose by 10% to $641 million as China contributed the most in importing dairy goods, the Statistics New Zealand data showed. Aside from the New Zealand trade balance data, the Reserve Bank of New Zealand’s (RBNZ) recent hawkish forecasts were mainly due to yesterday’s release of the annual budget. New Zealand Prime Minister Chris Hipkins has focused his Budget on people’s livelihoods as many New Zealanders struggle to meet day-to-day expenses due to high inflation. To solve the problems of NZ’s livelihood, more budgets are implemented by the government into the market, which will cause inflation to remain stubbornly high. Nonetheless, the gains of the Kiwi were limited by weakened consumer spending. Credit card spending growth was reduced to 11.4% versus 12.5% lower than prior readings of 19.7%. As of writing, the NZD/USD was lifted by 0.19% to 0.6238.

In the commodities market, crude oil prices ticked up by 0.81% to $72.44 per barrel as optimism over raising the US debt ceiling. Besides, gold prices rebounded by 0.23% to $1961.99 per troy ounce following the prior experienced a massive sell-off by global investors.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | -0.7% | -0.8% | – |

Technical Analysis

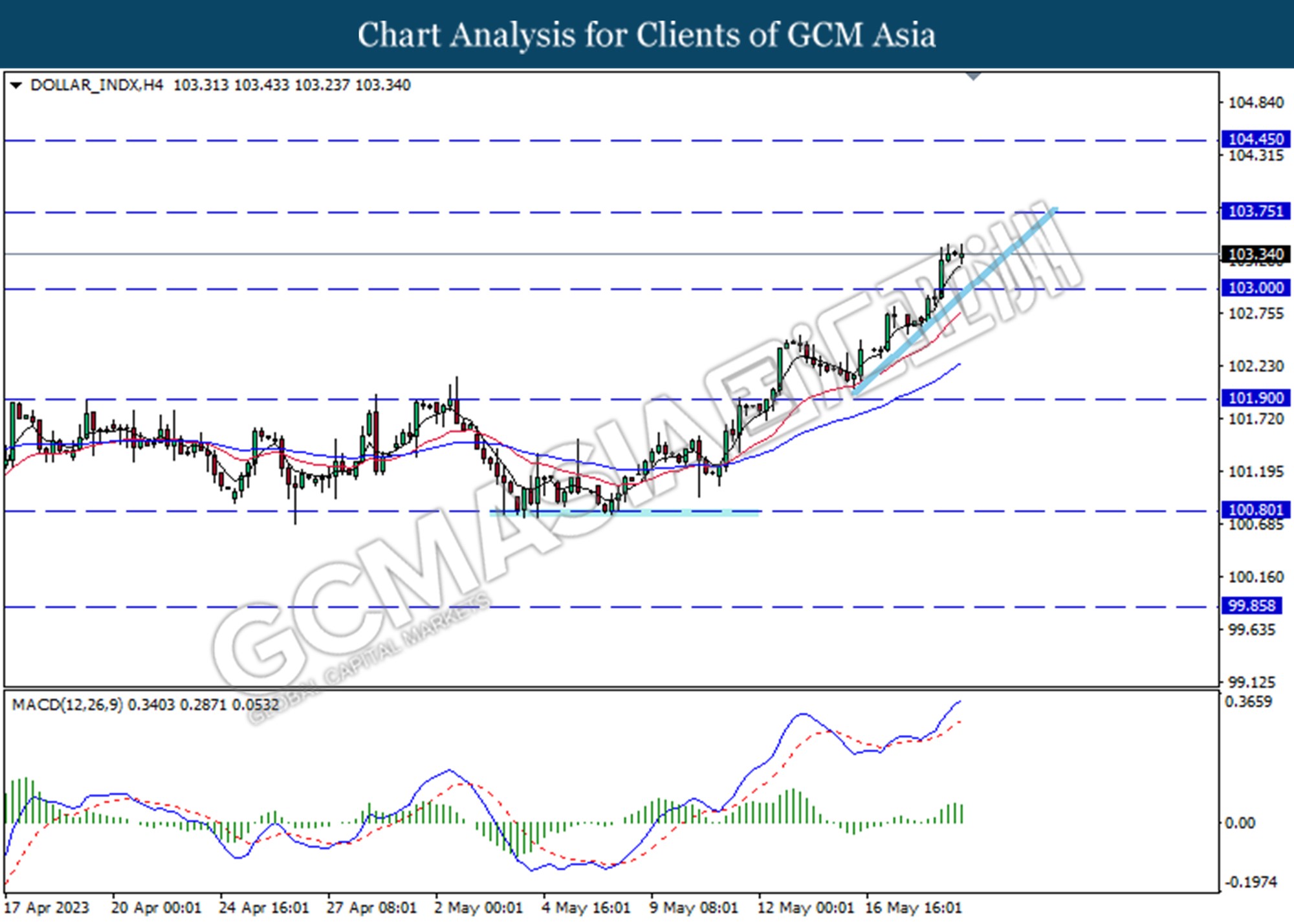

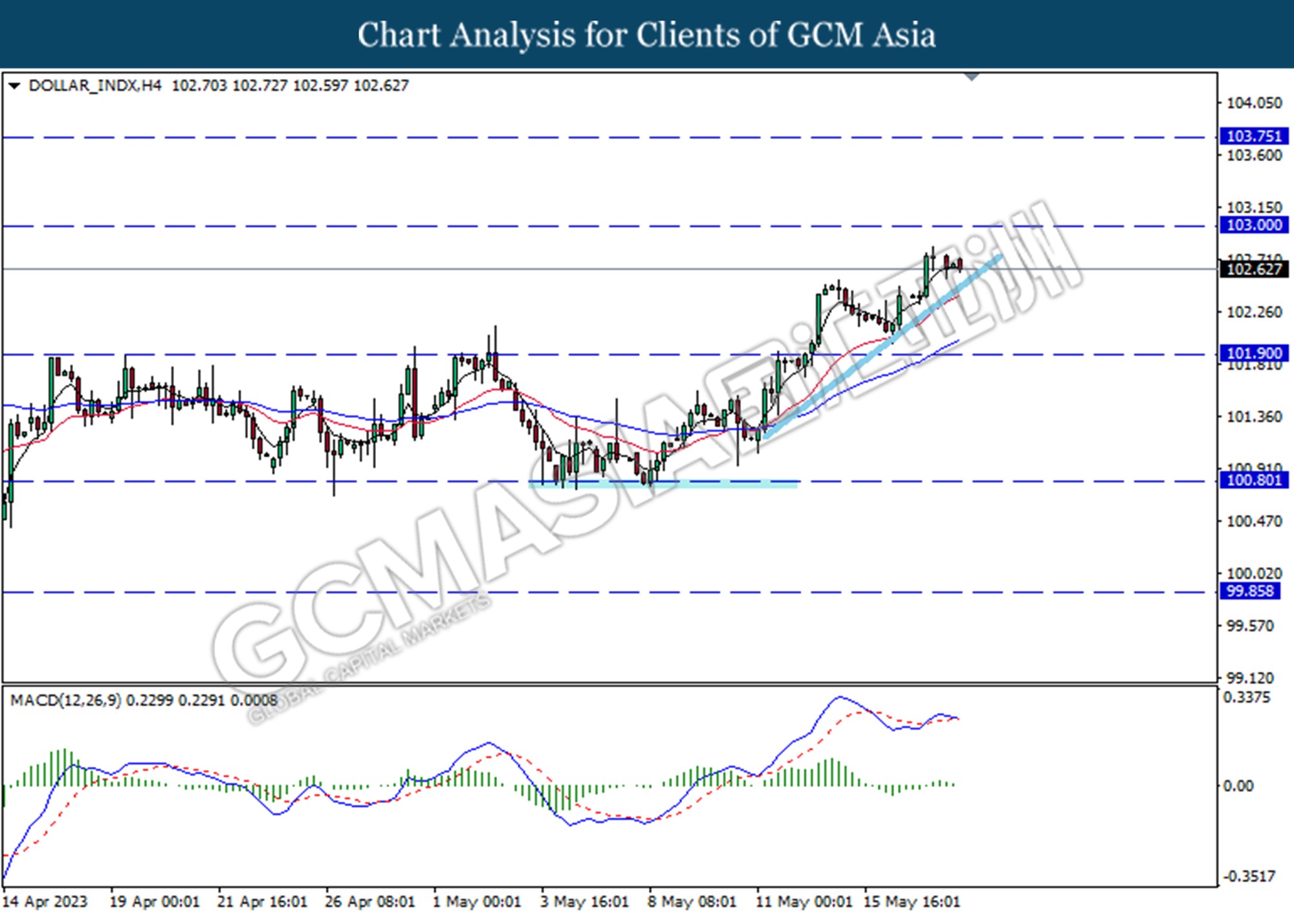

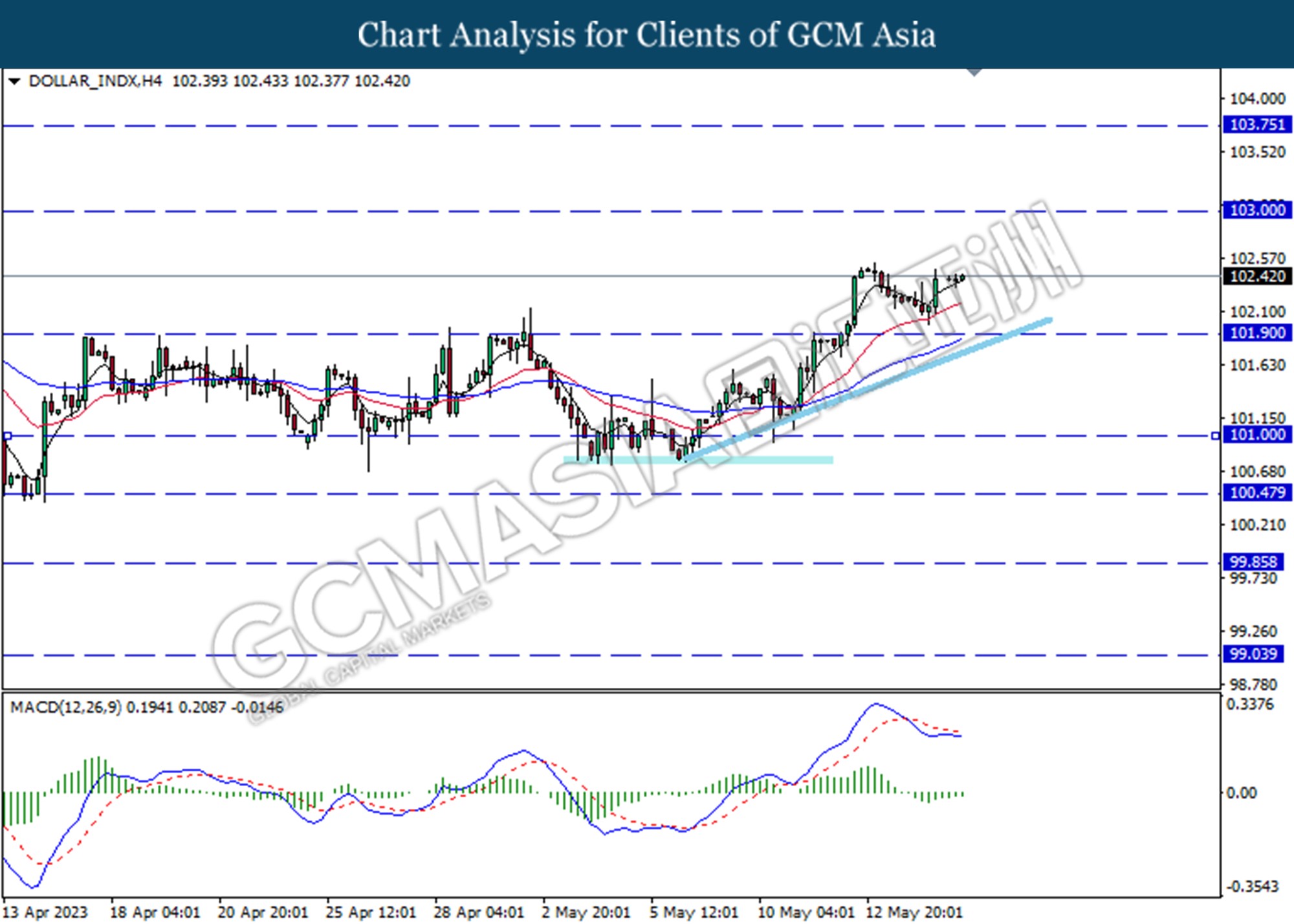

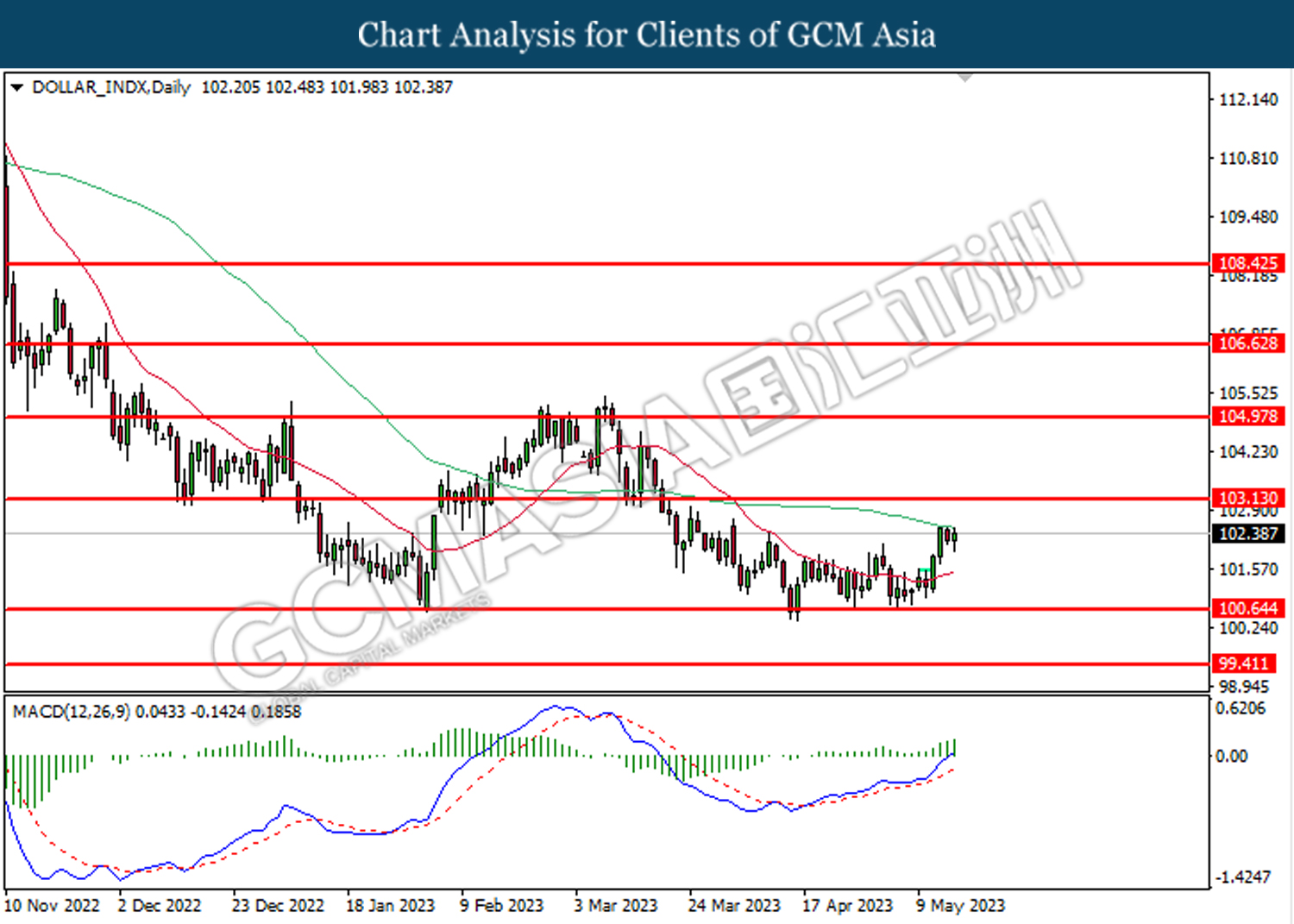

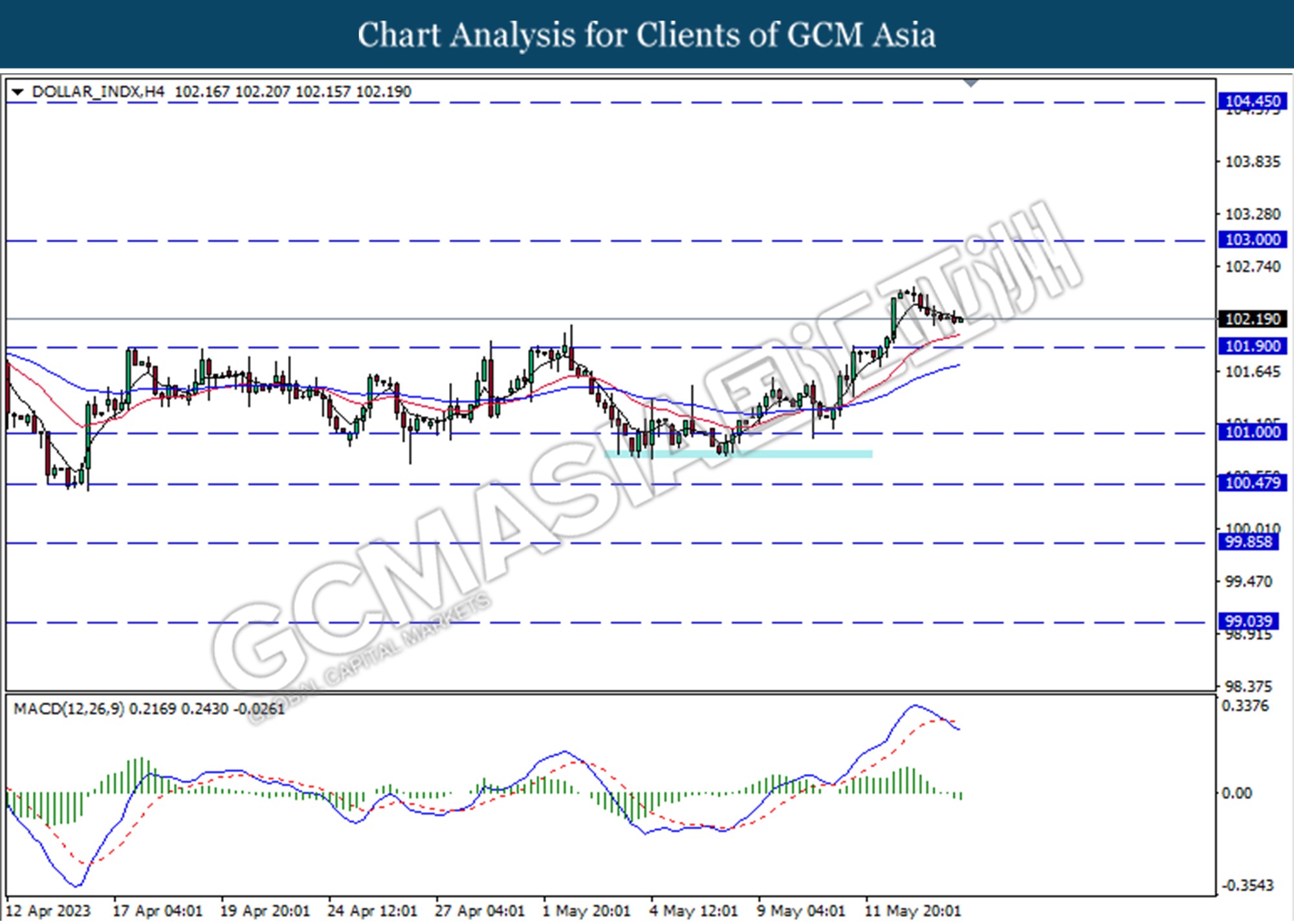

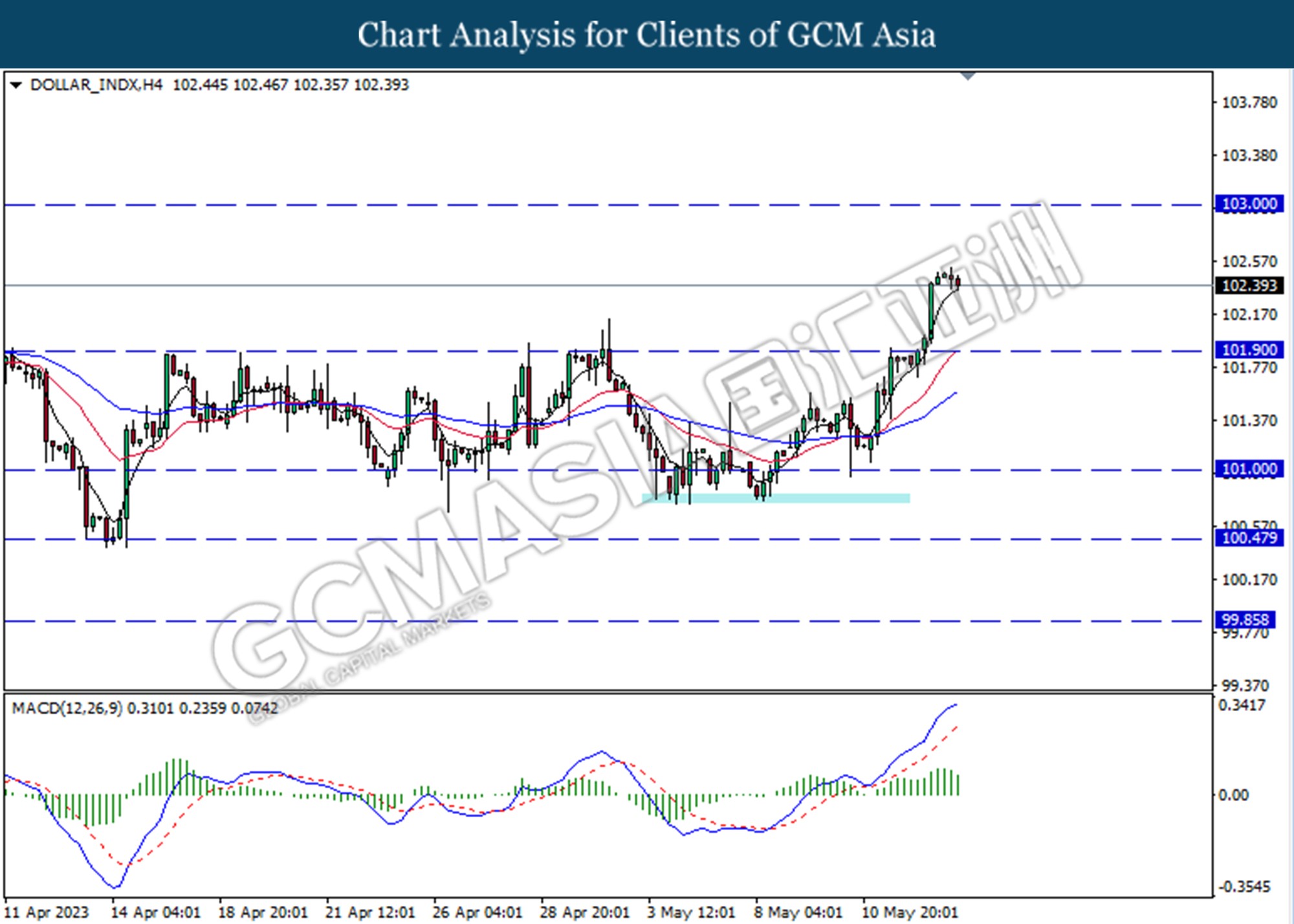

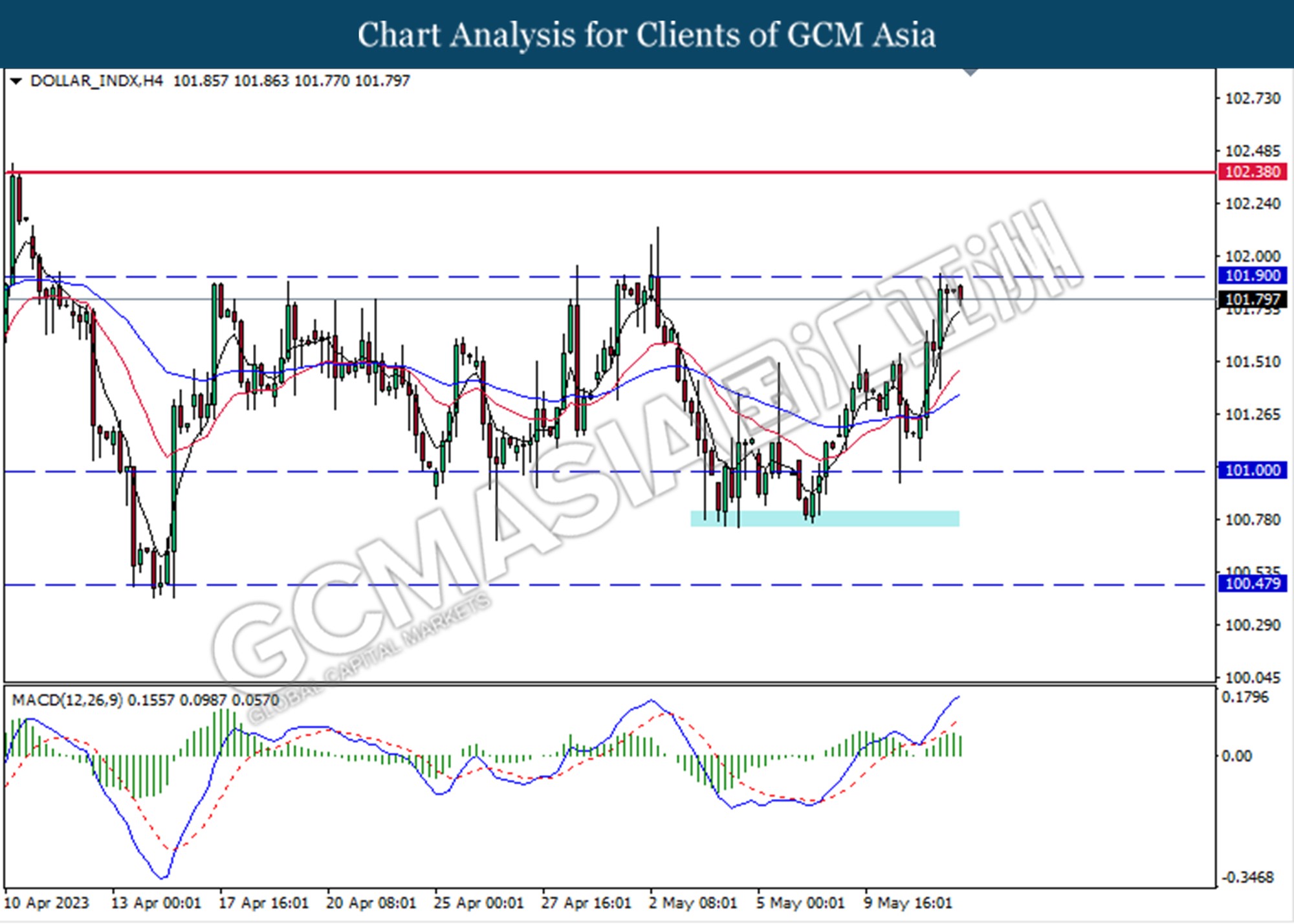

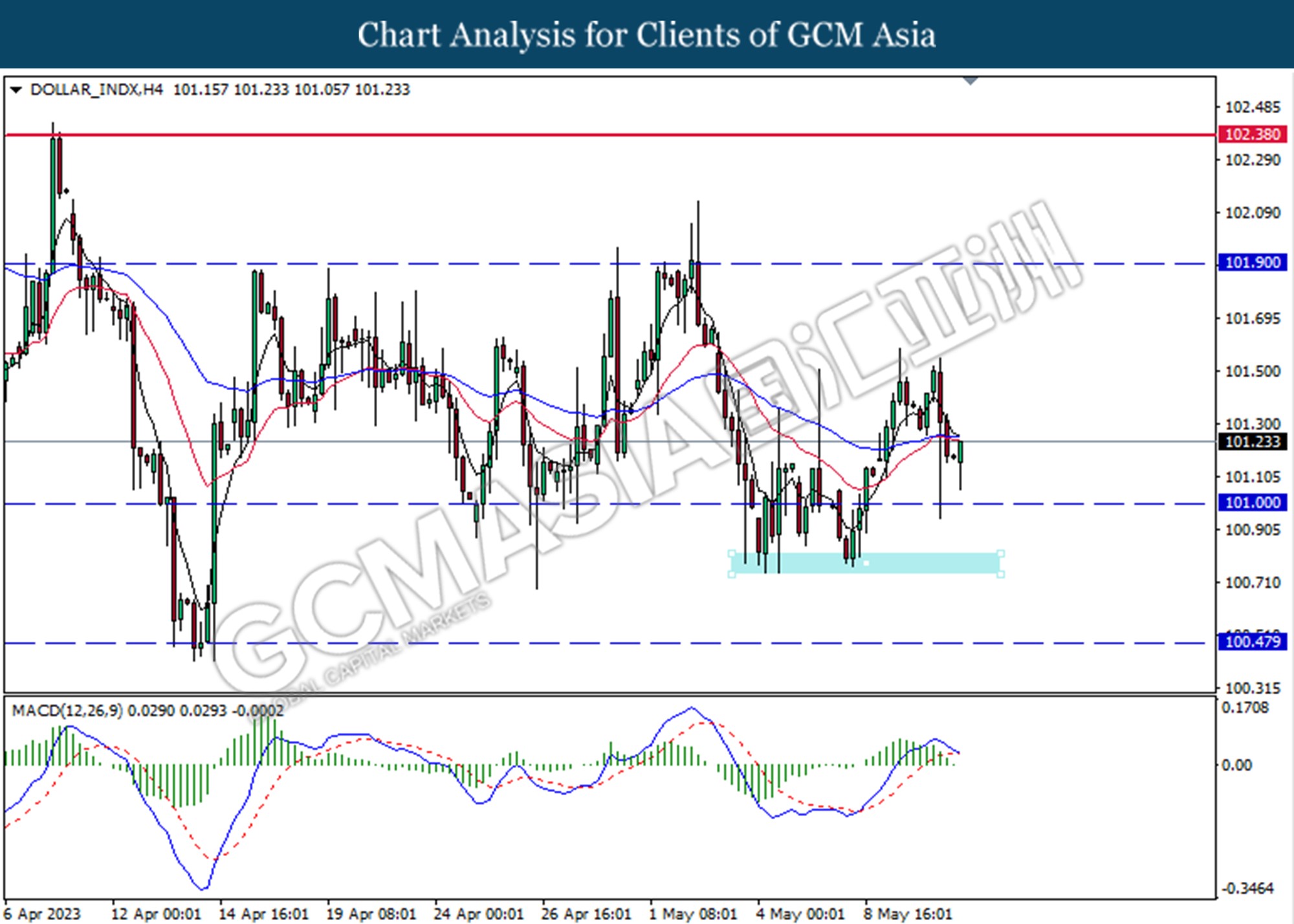

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breaks above the resistance level at 103.00. However, MACD which illustrated diminishing bullish momentum suggests the index traded lower as a technical correction.

Resistance level: 103.75, 104.45

Support level: 103.00, 101.90

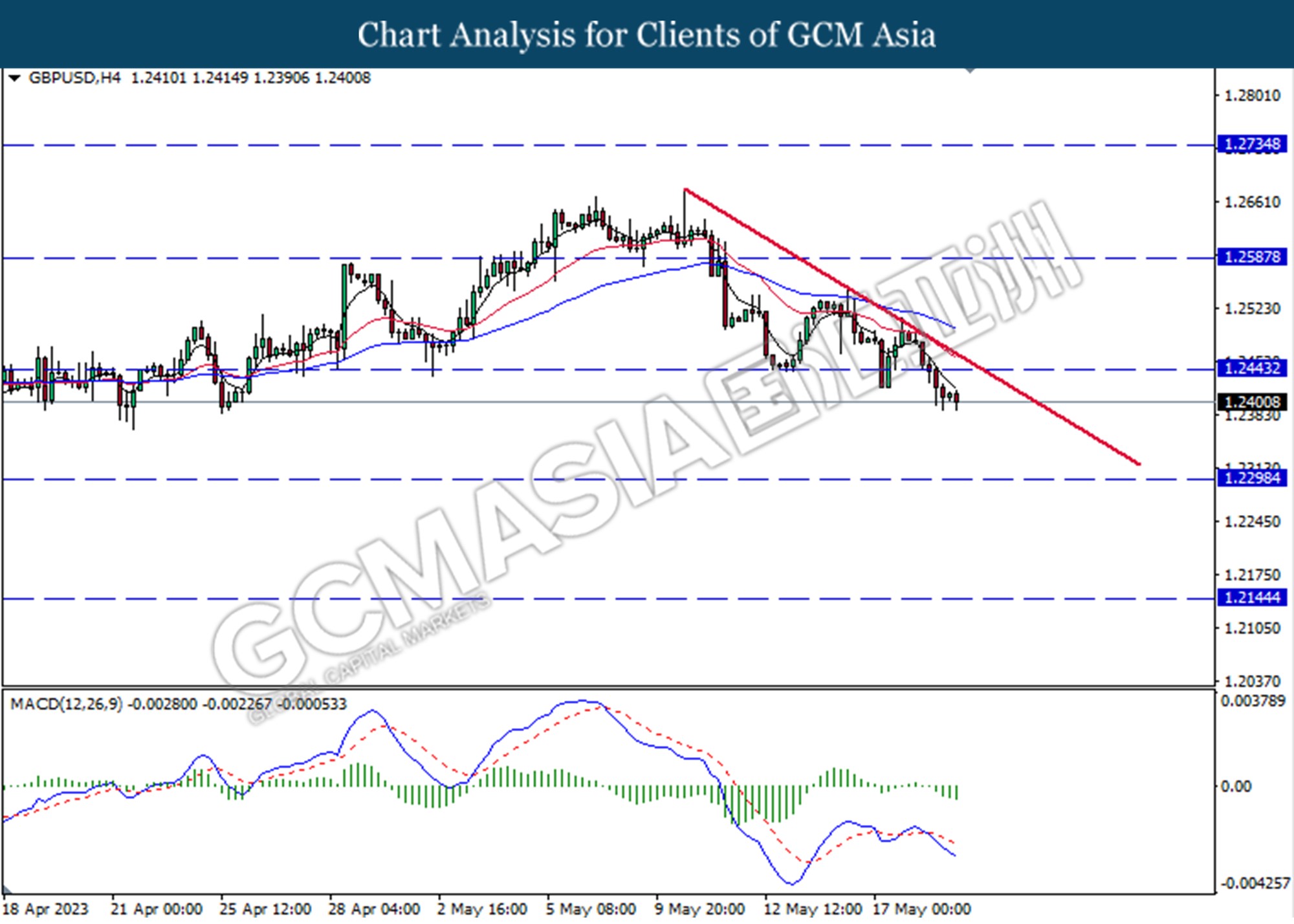

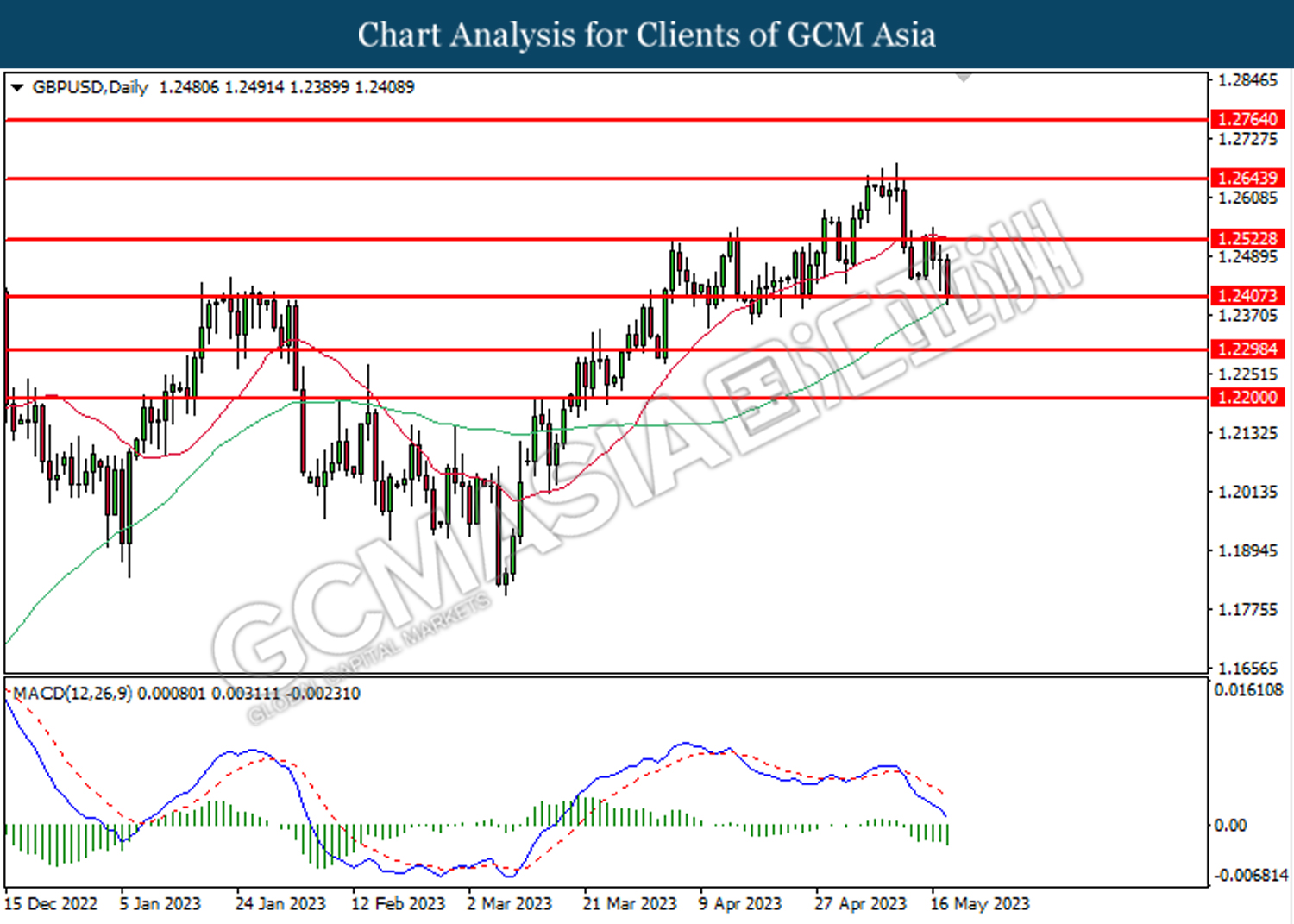

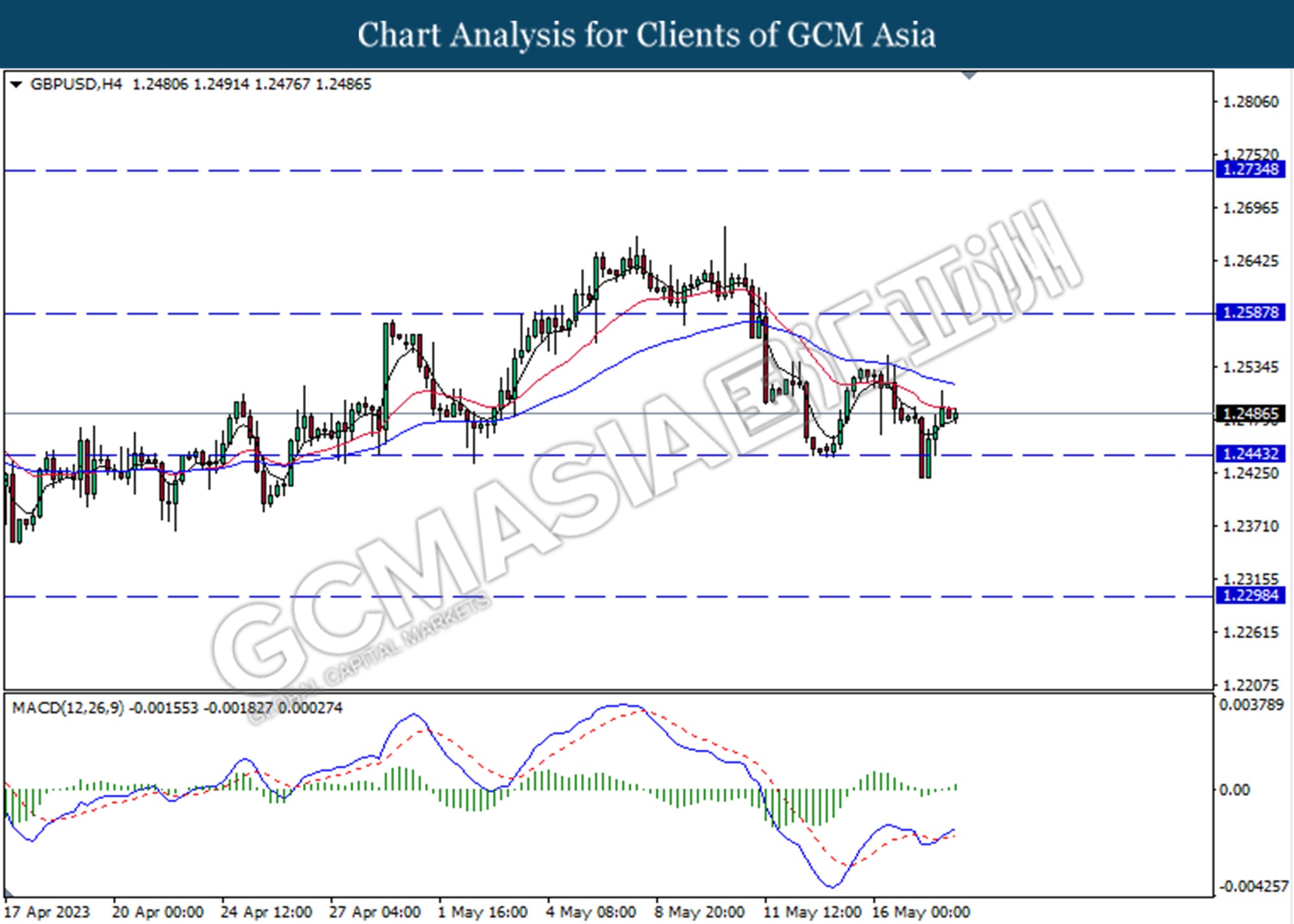

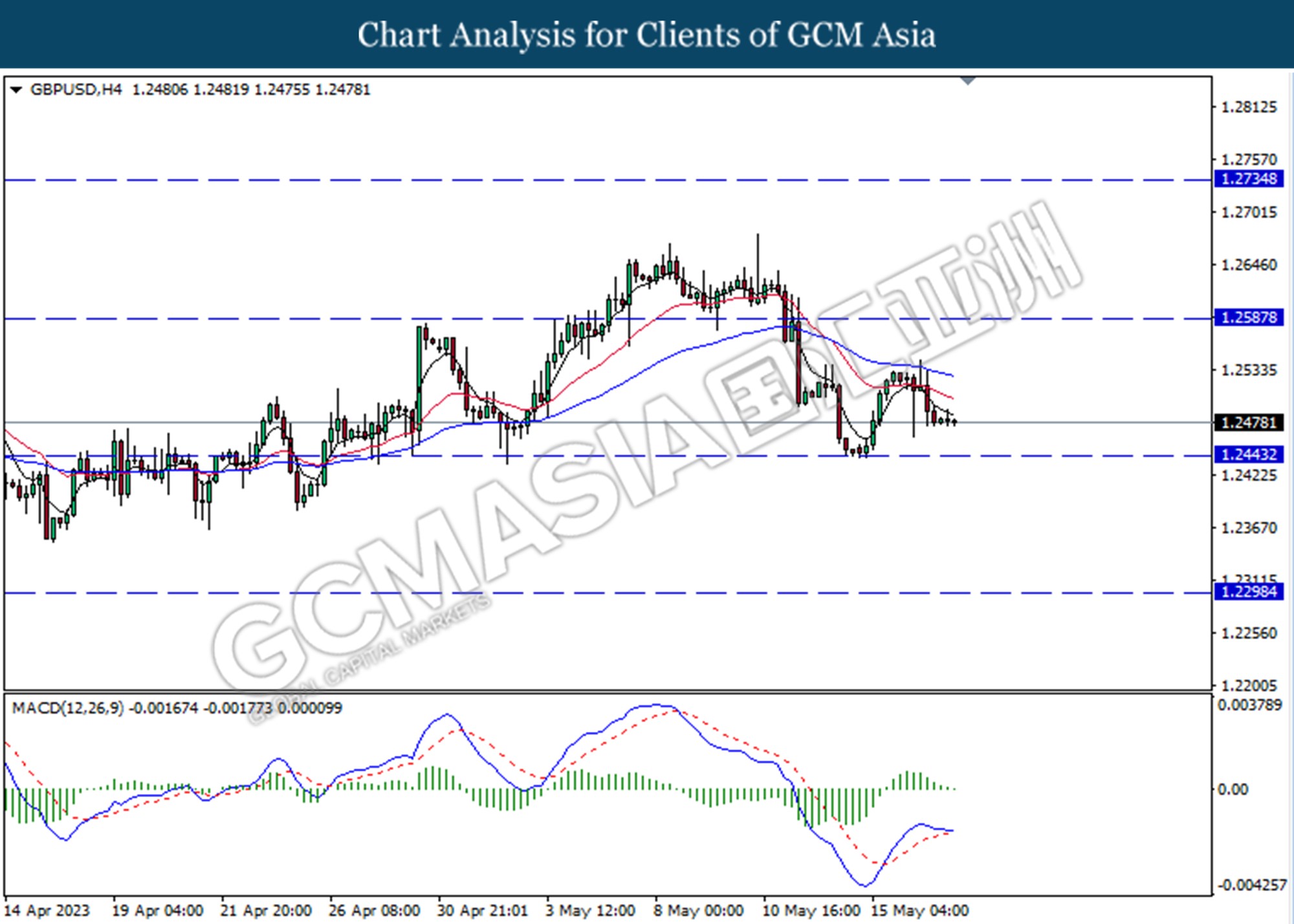

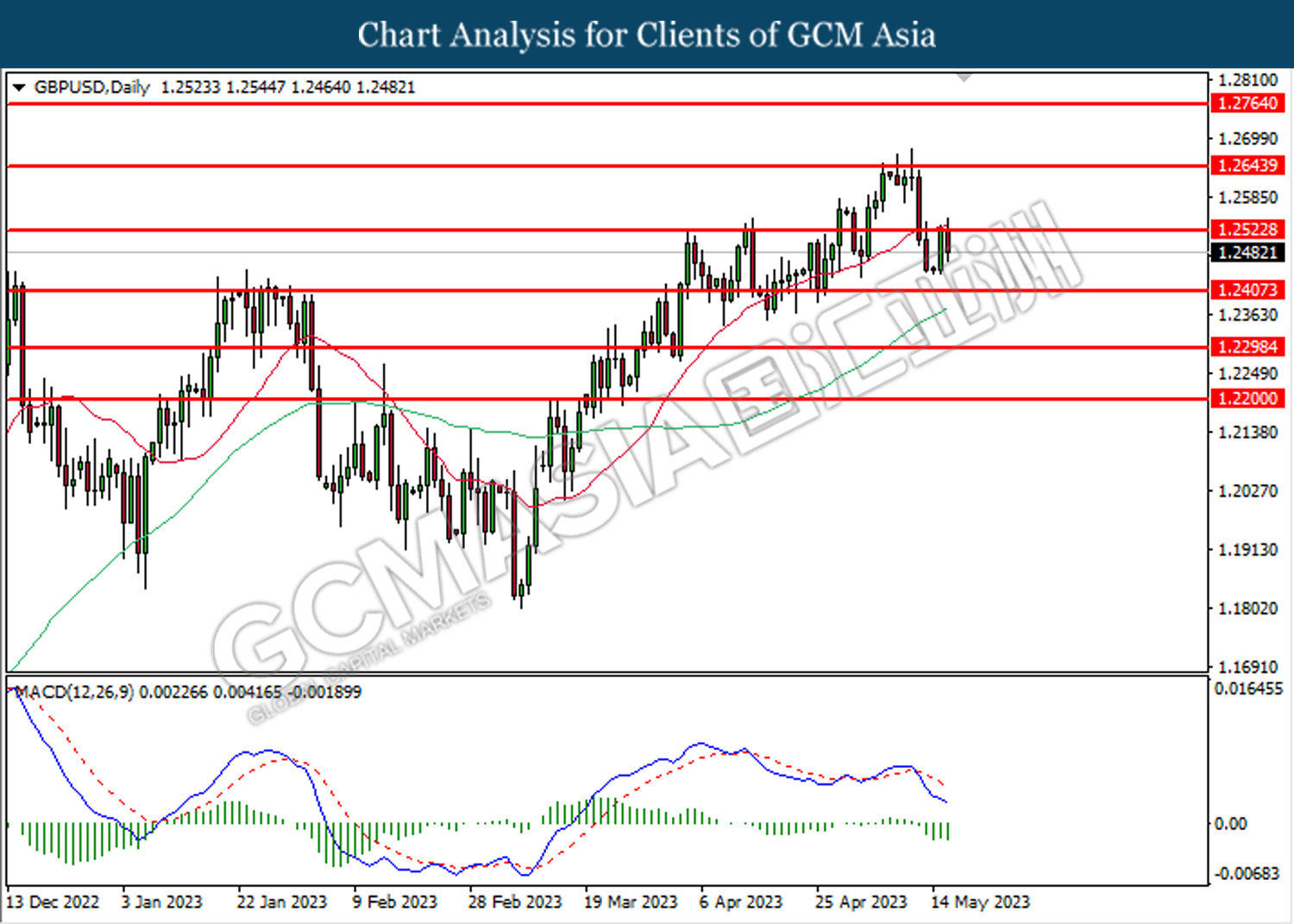

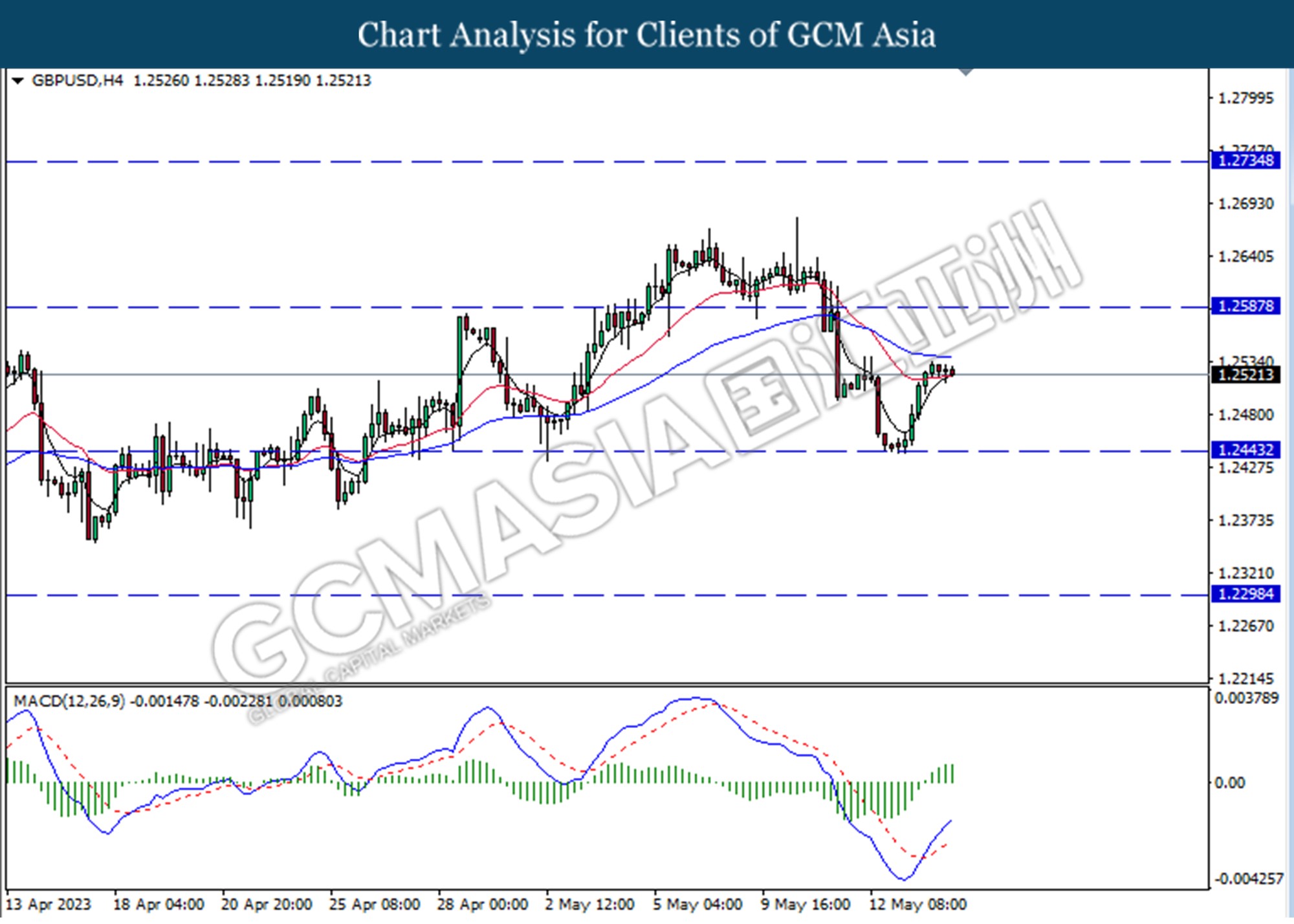

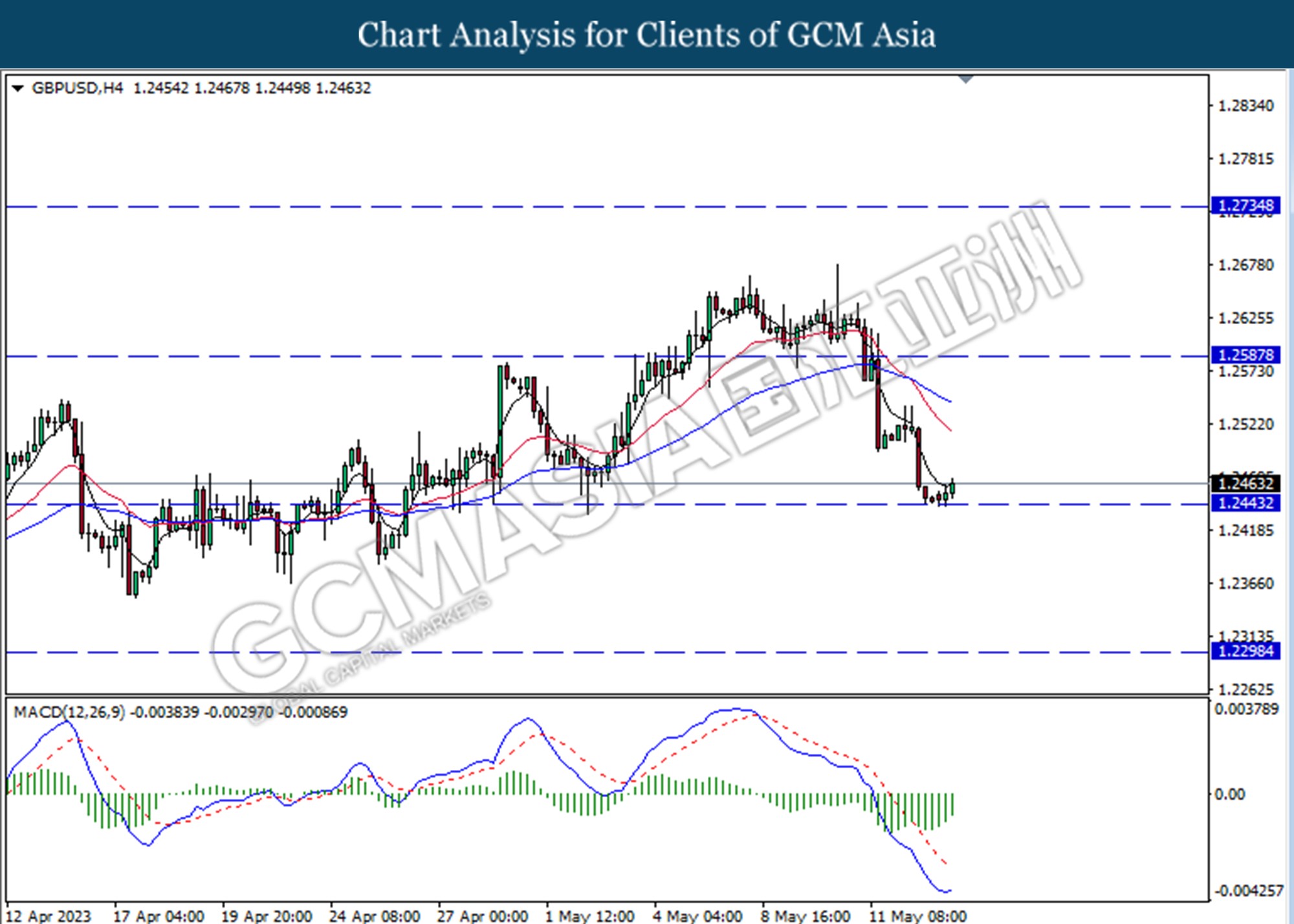

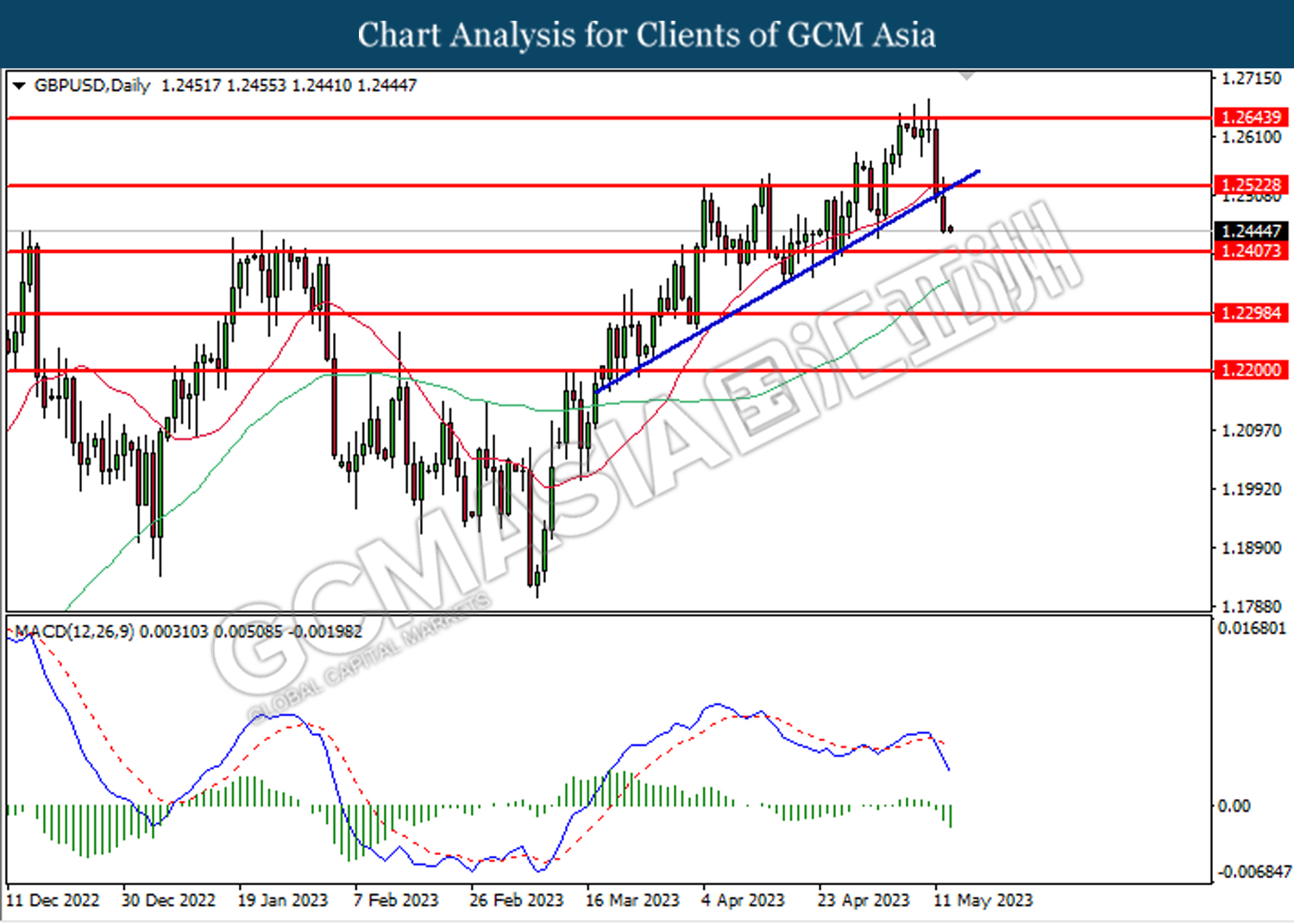

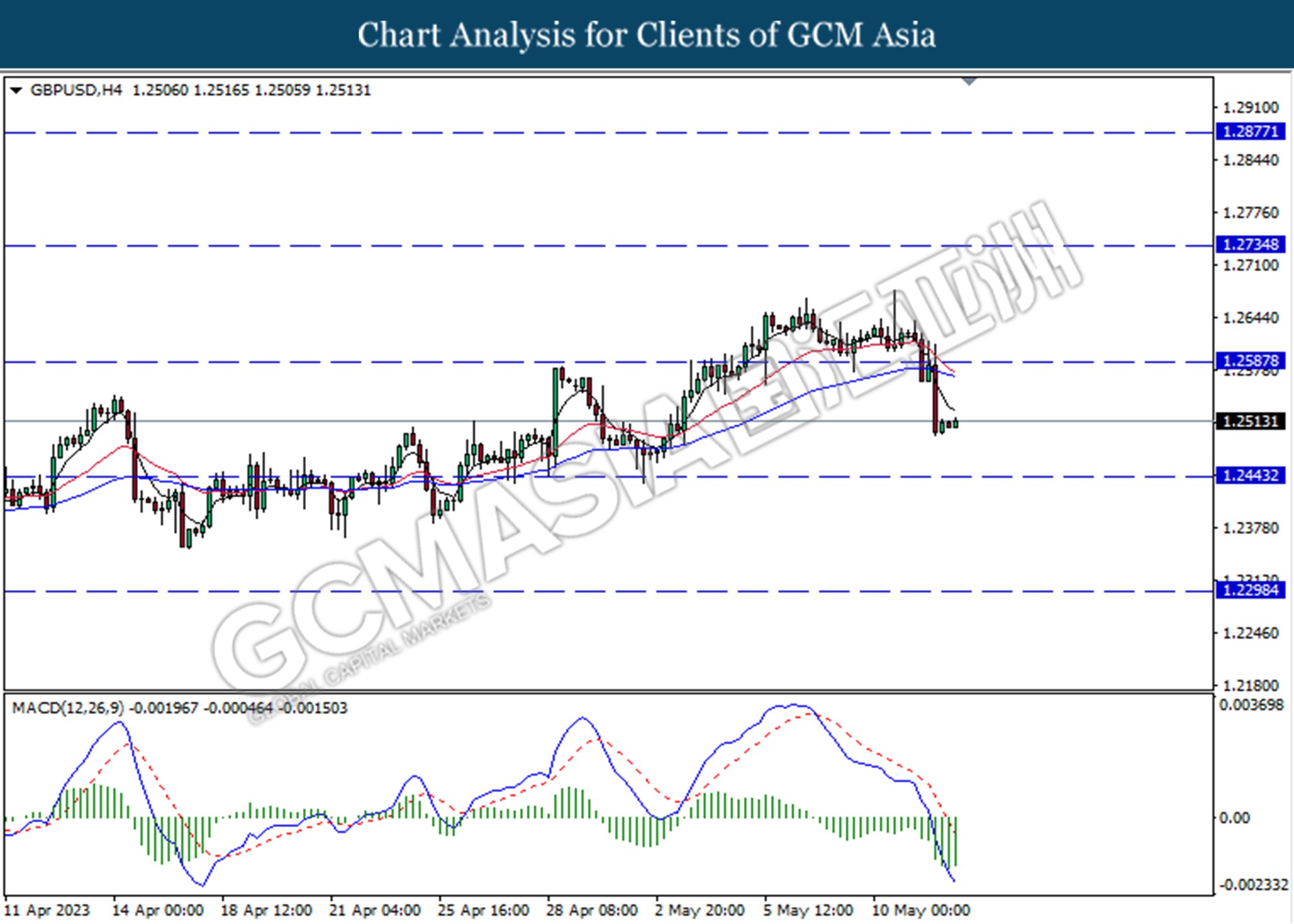

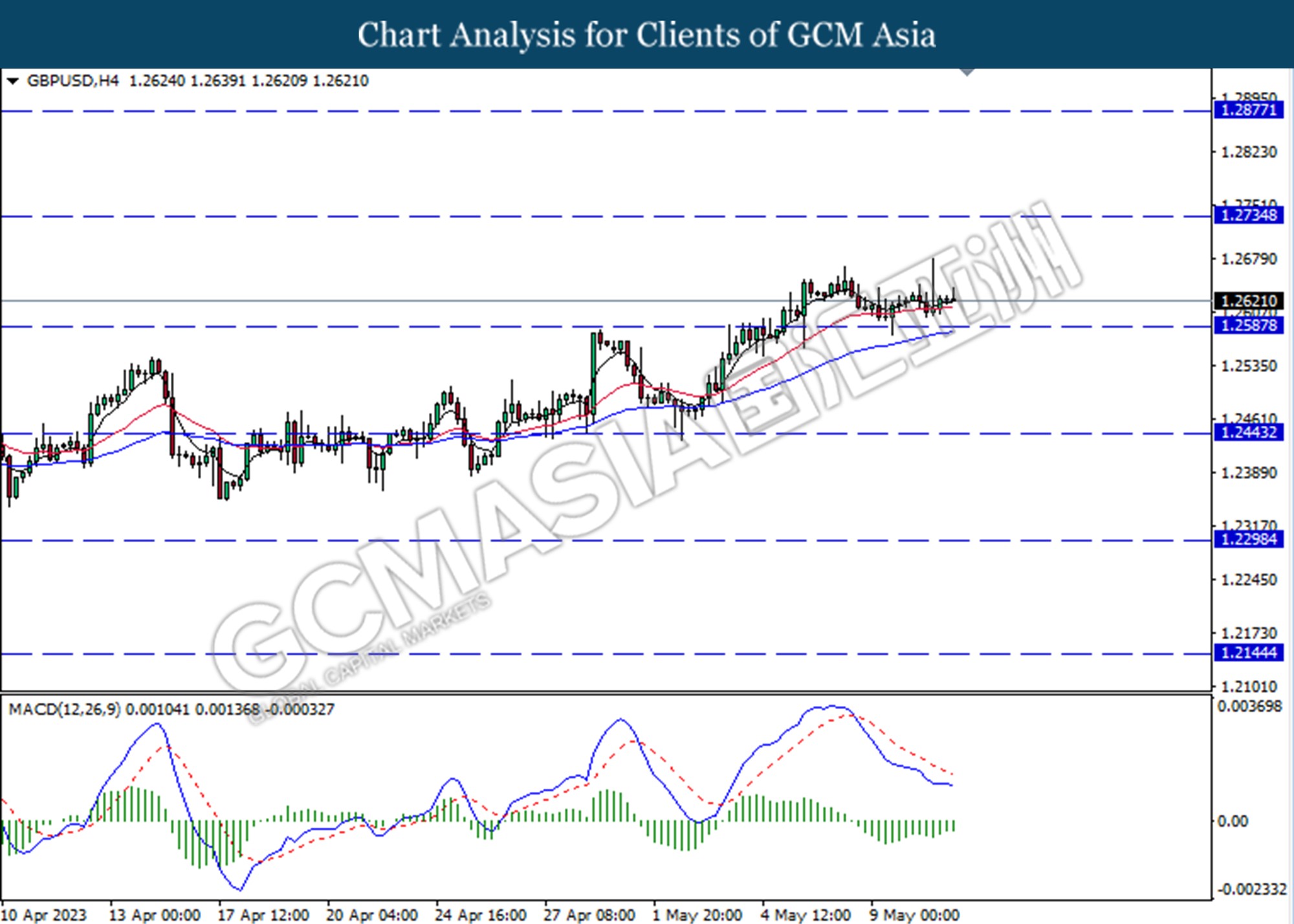

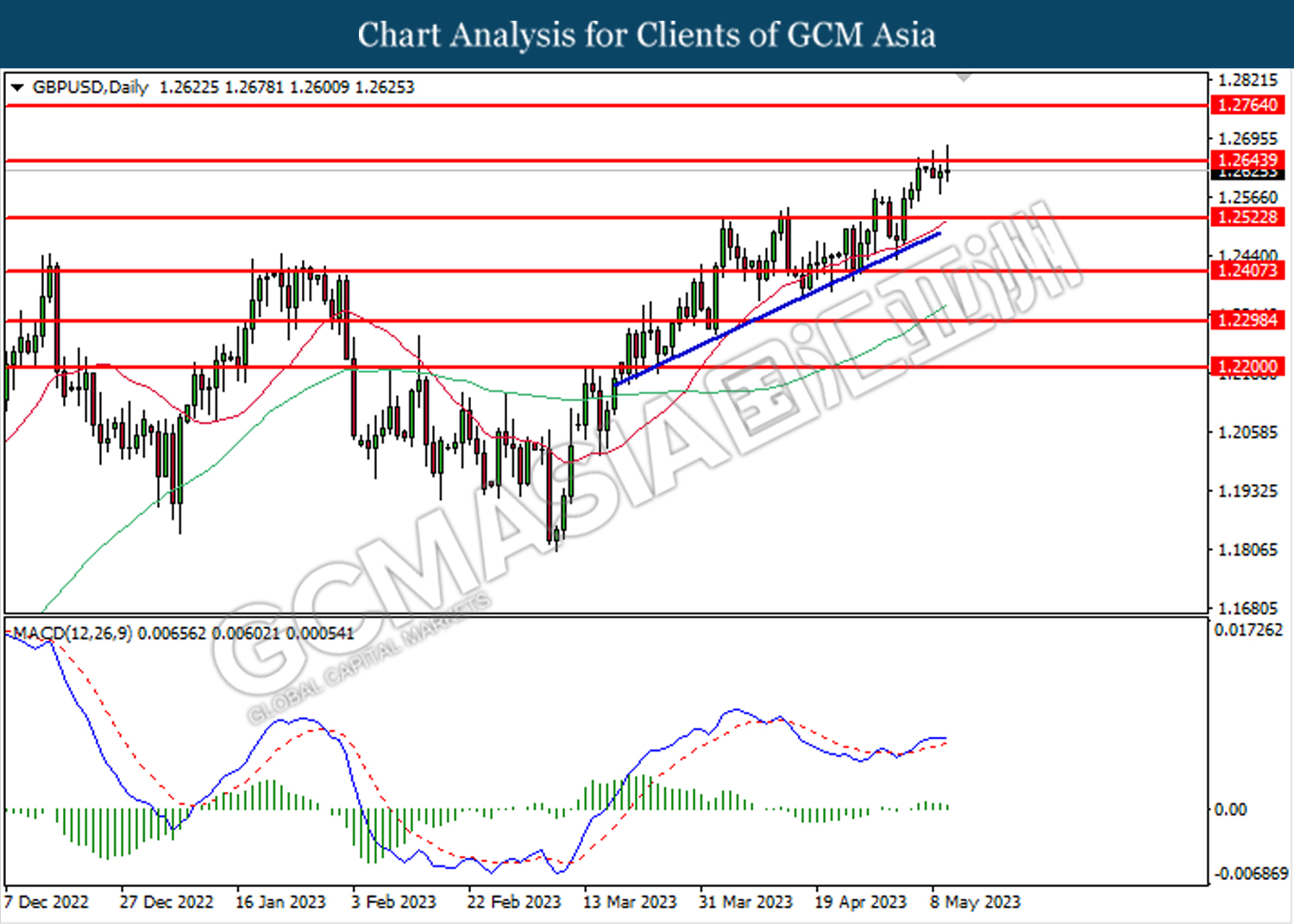

GBPUSD, H4: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2445. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2300.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

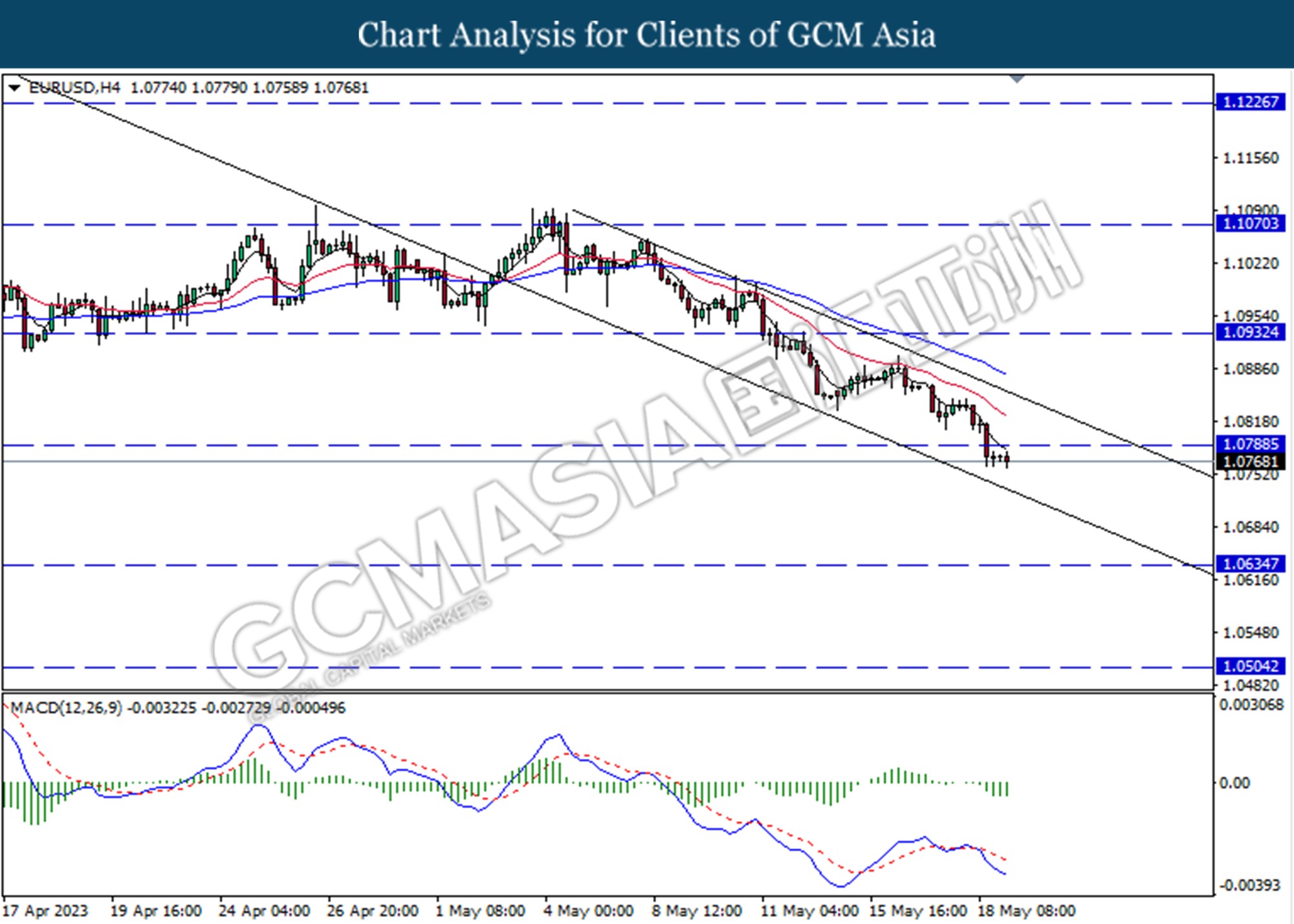

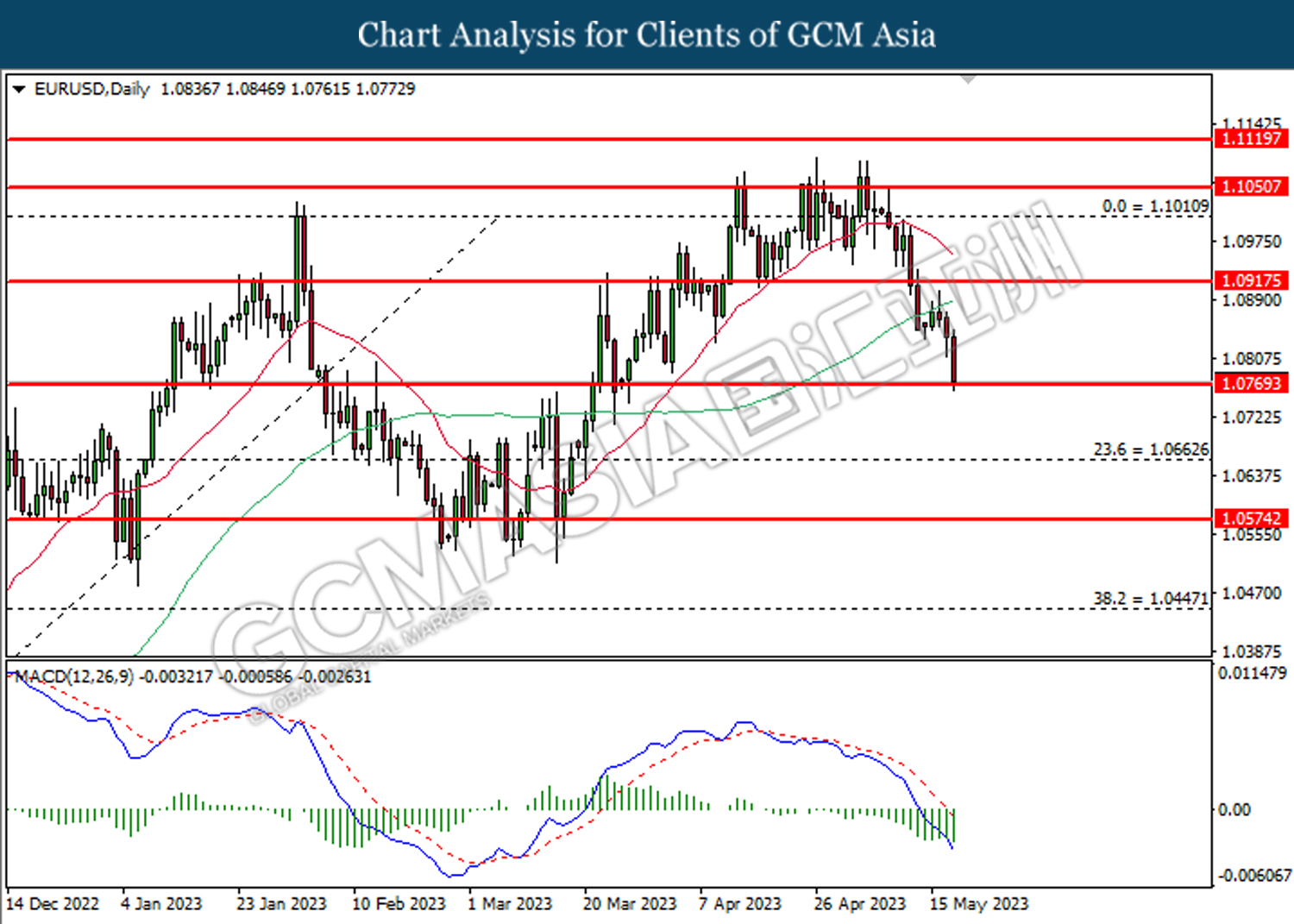

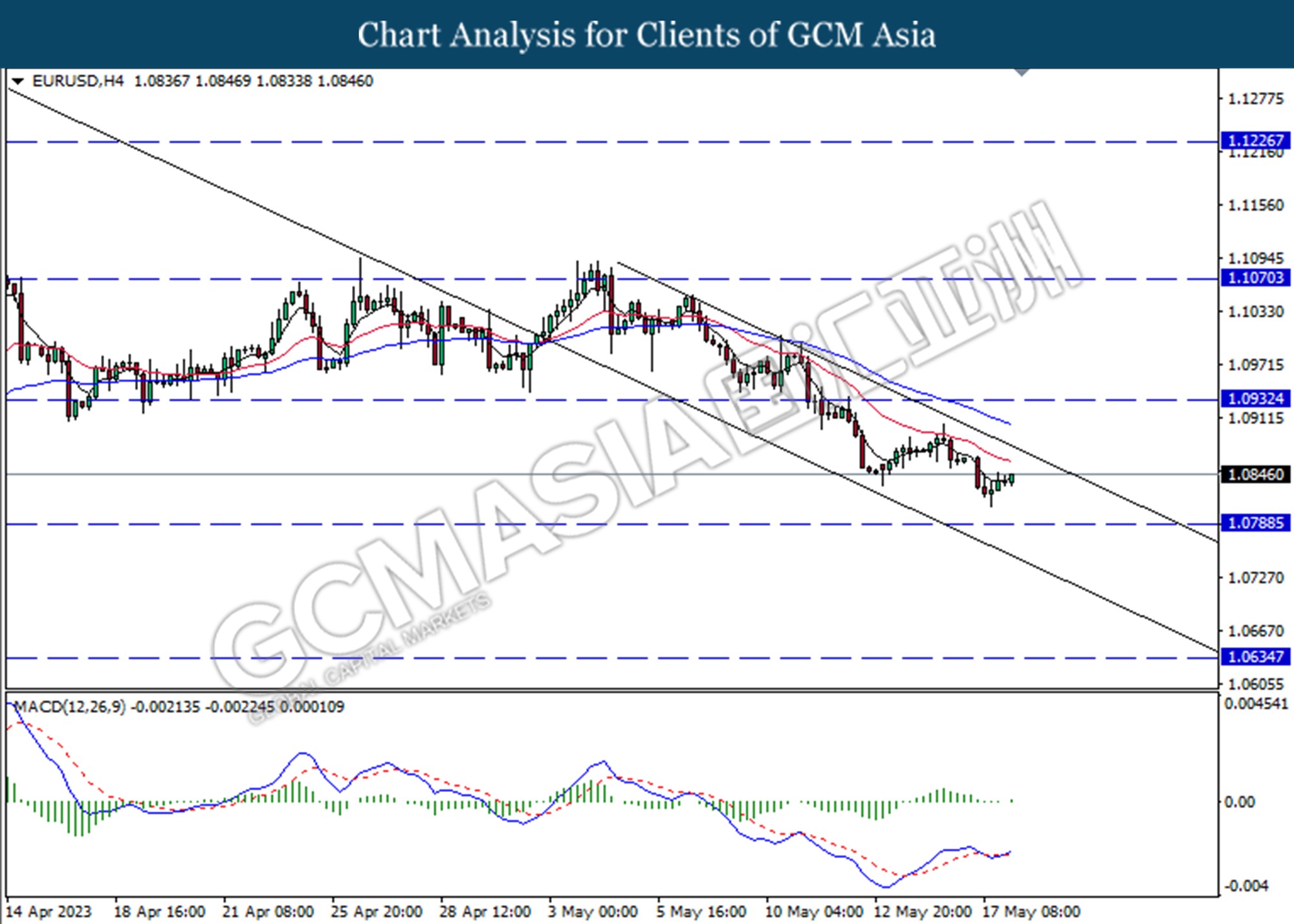

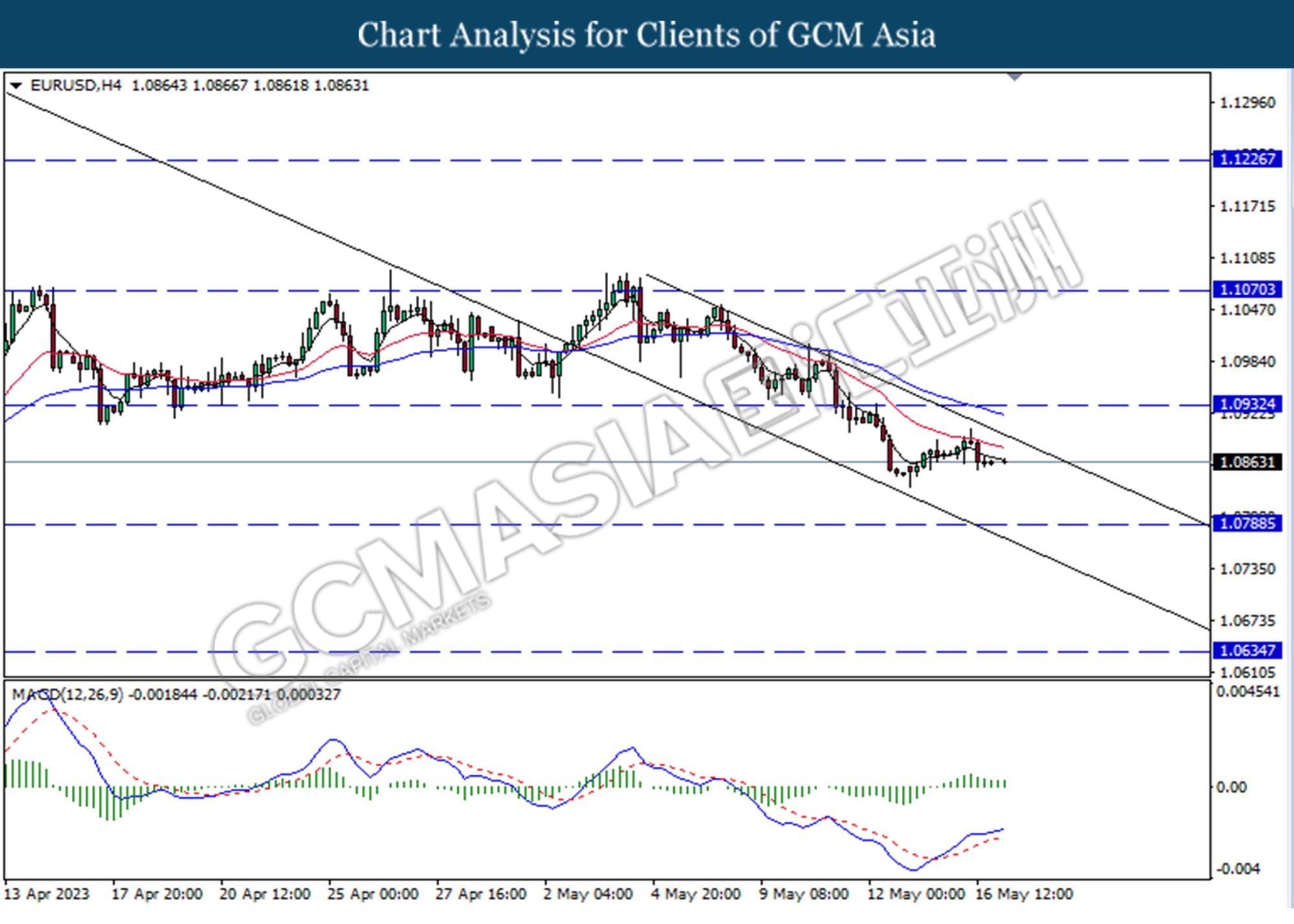

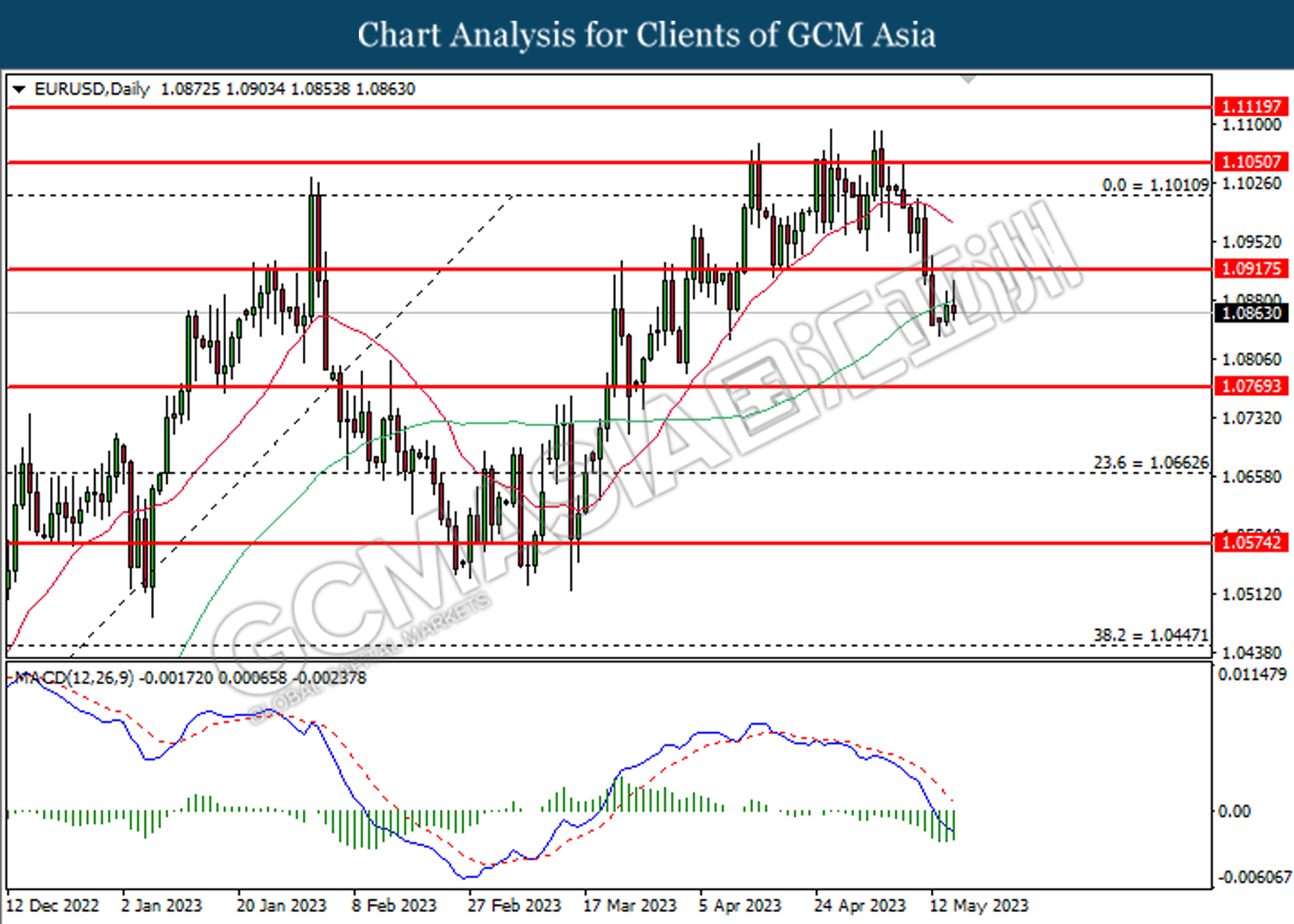

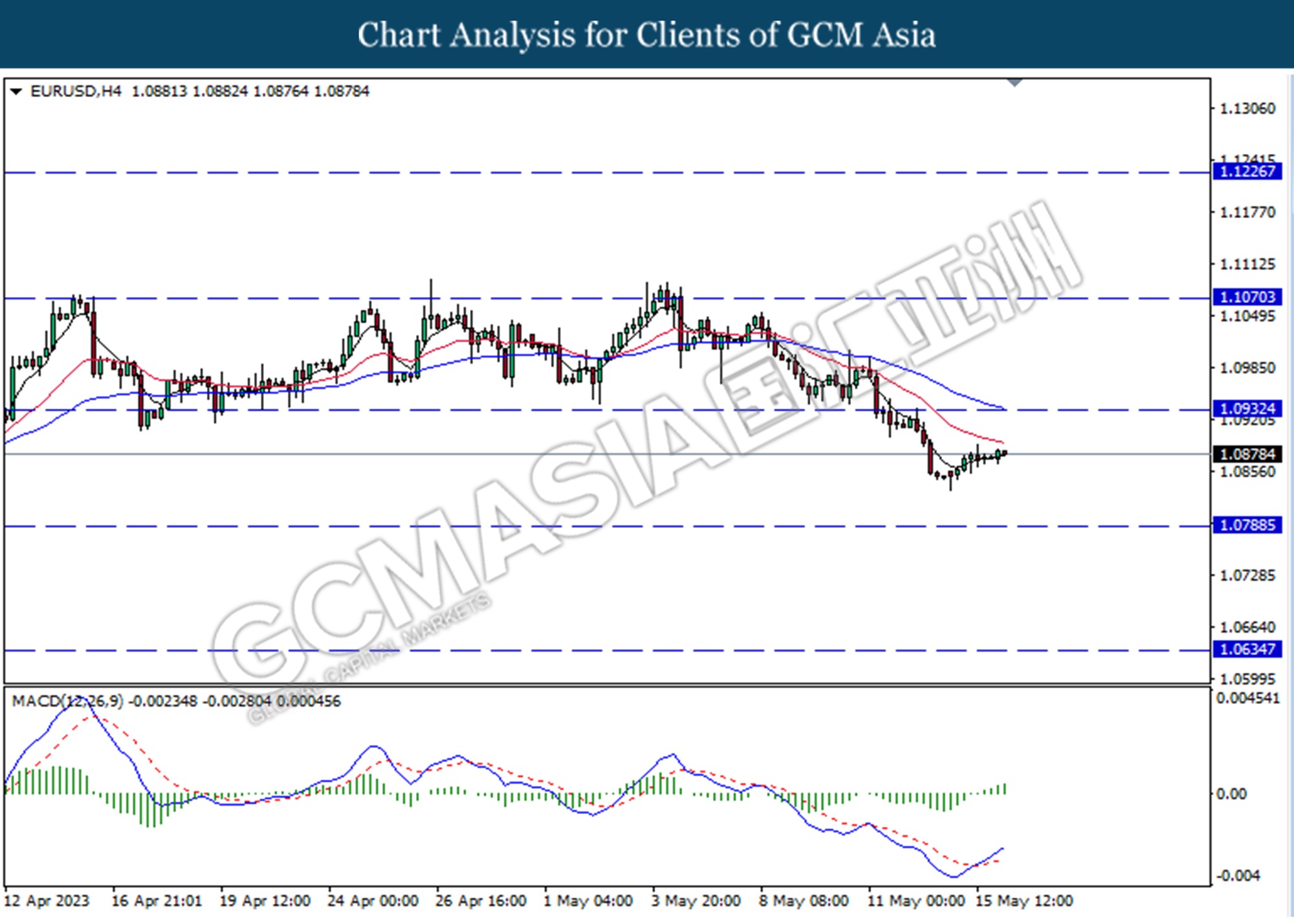

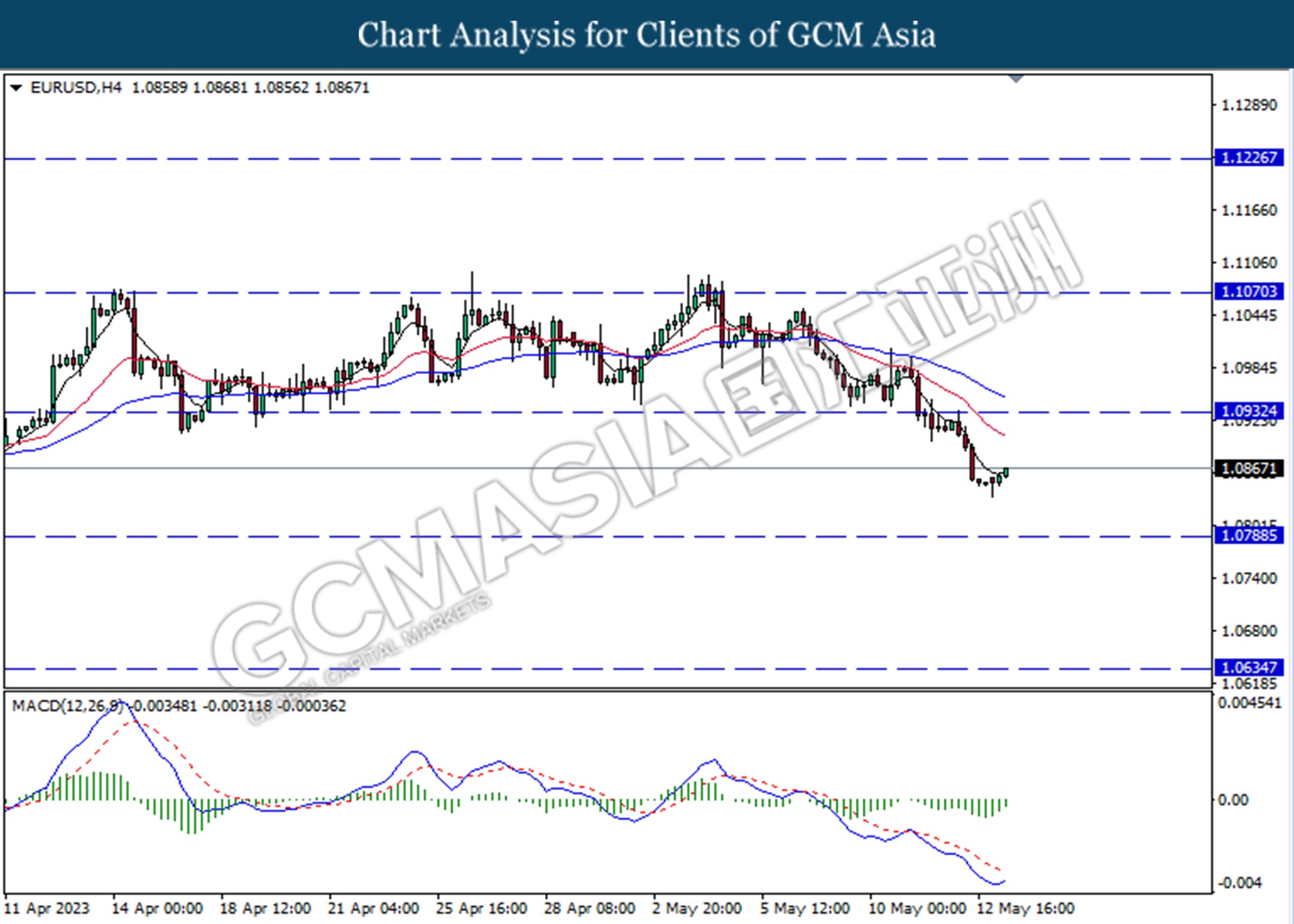

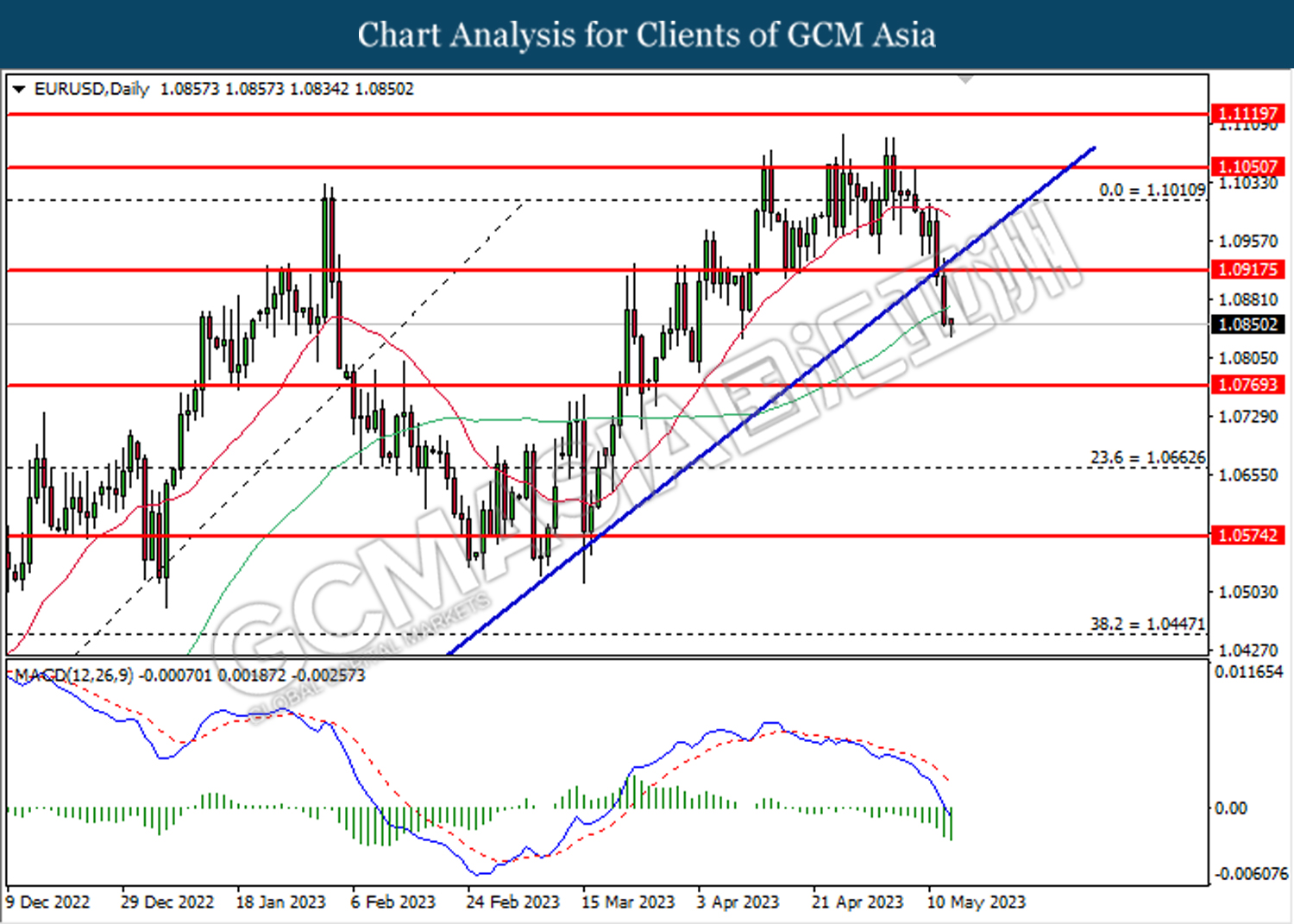

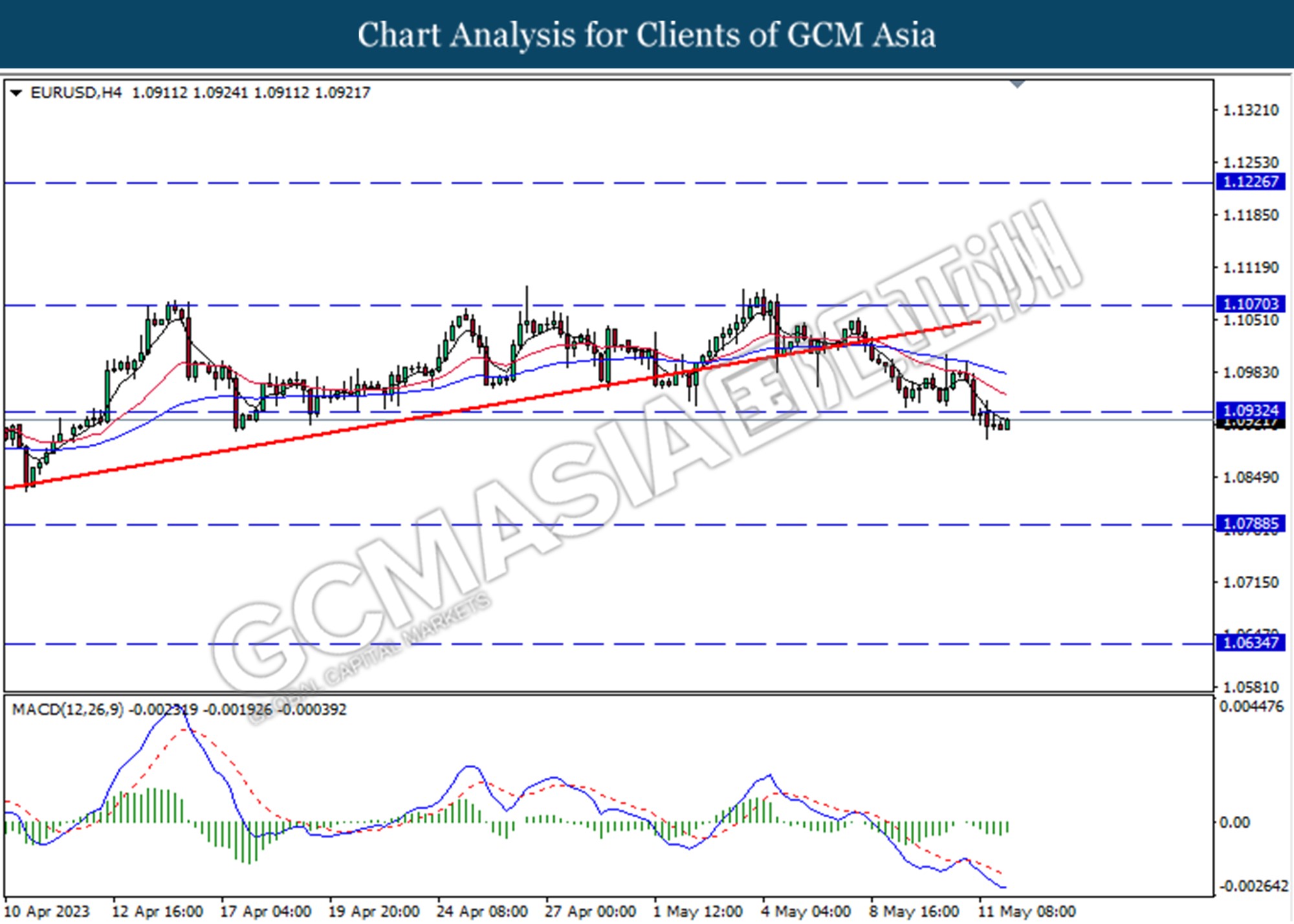

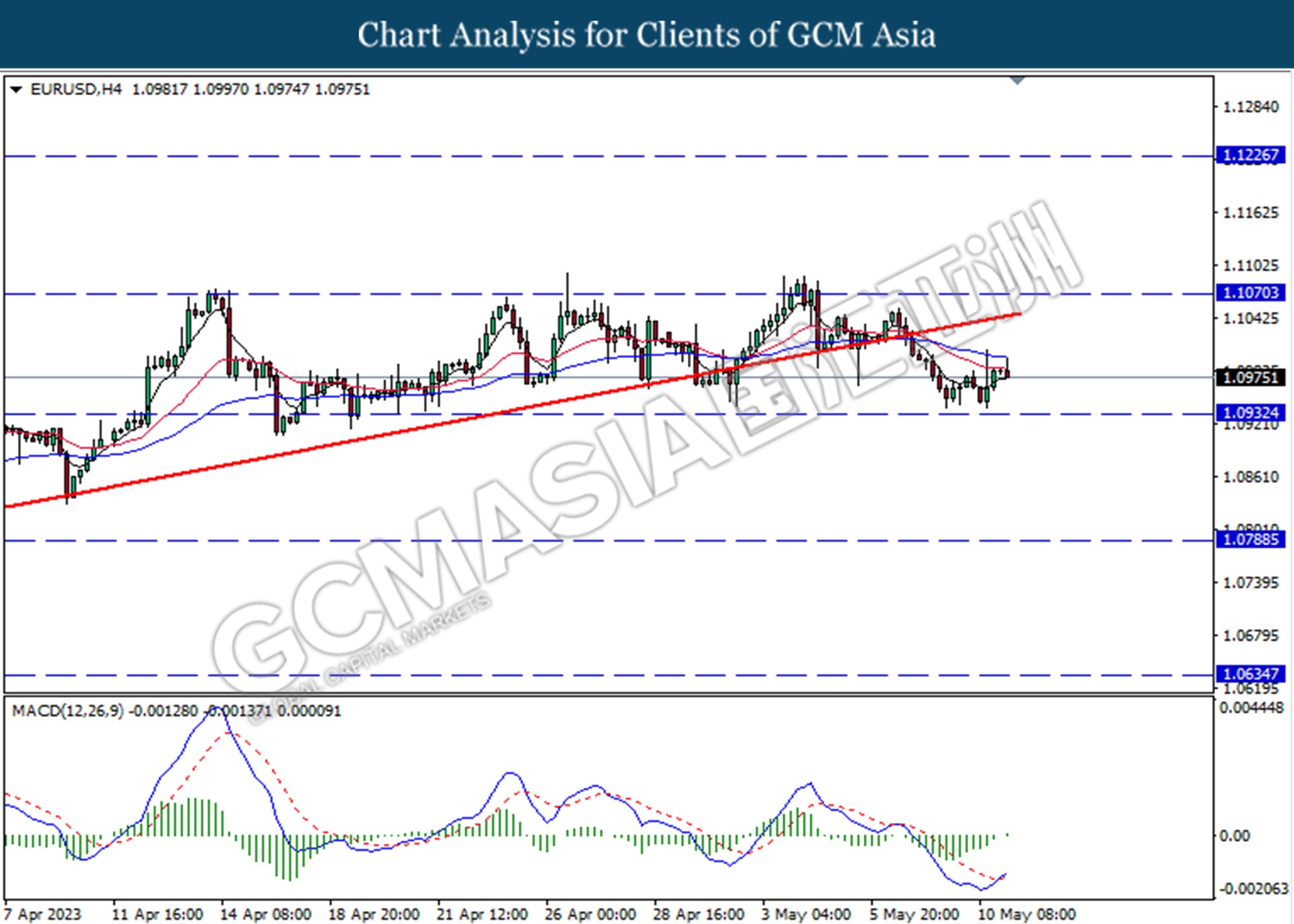

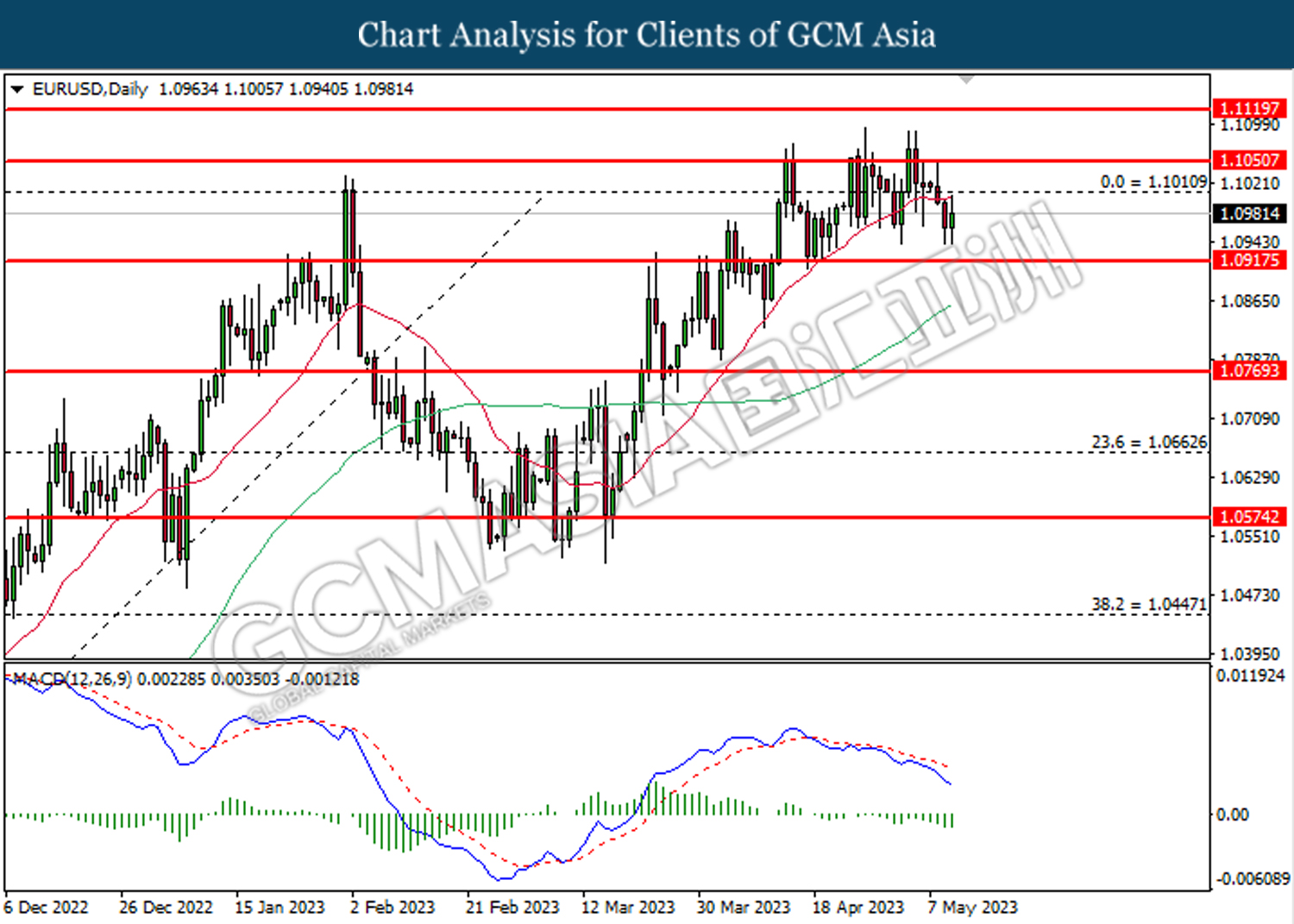

EURUSD, H4: EURUSD was traded lower following the prior breaks below the previous support level at 1.0790. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0935

Support level: 1.0635, 1.0505

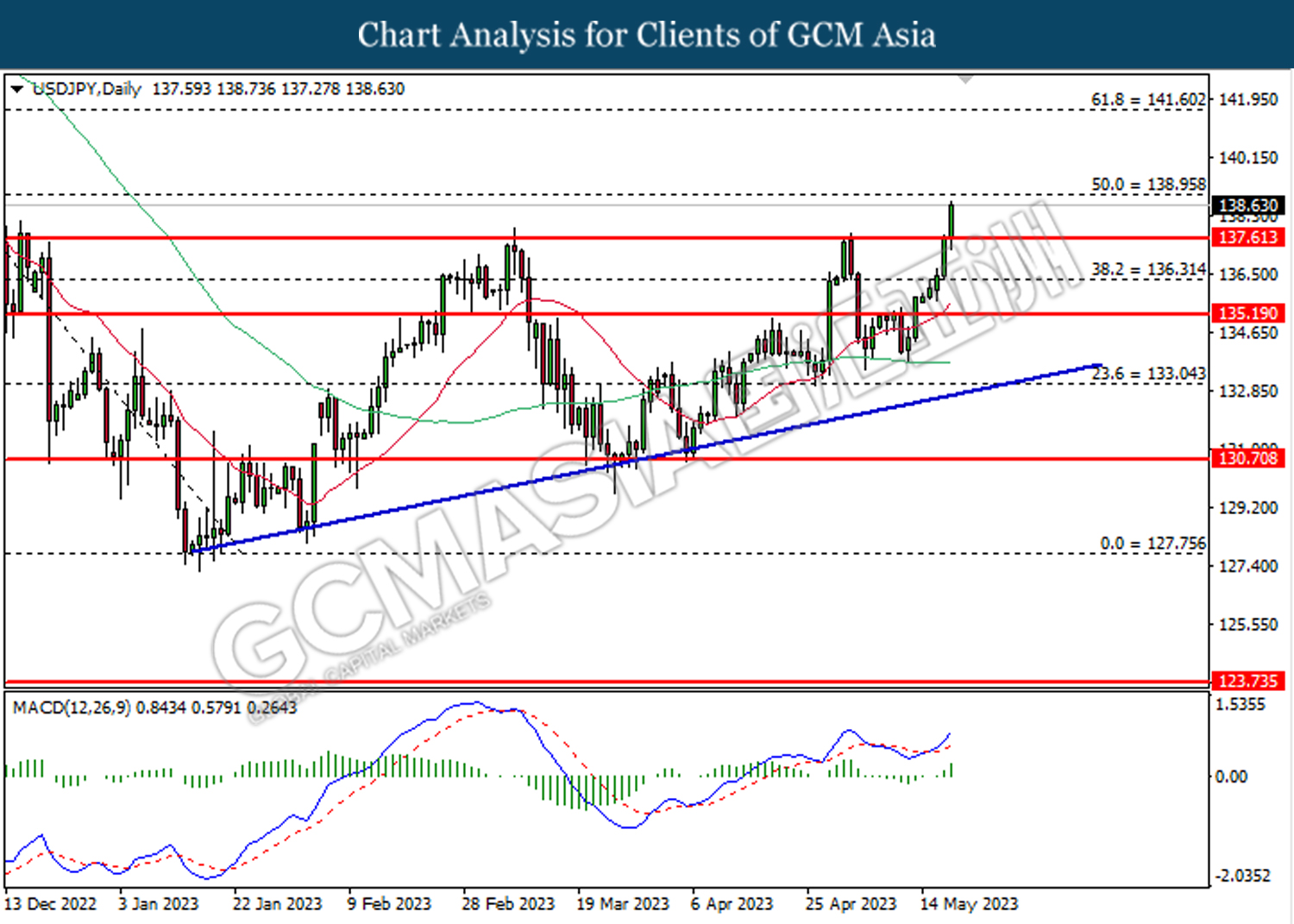

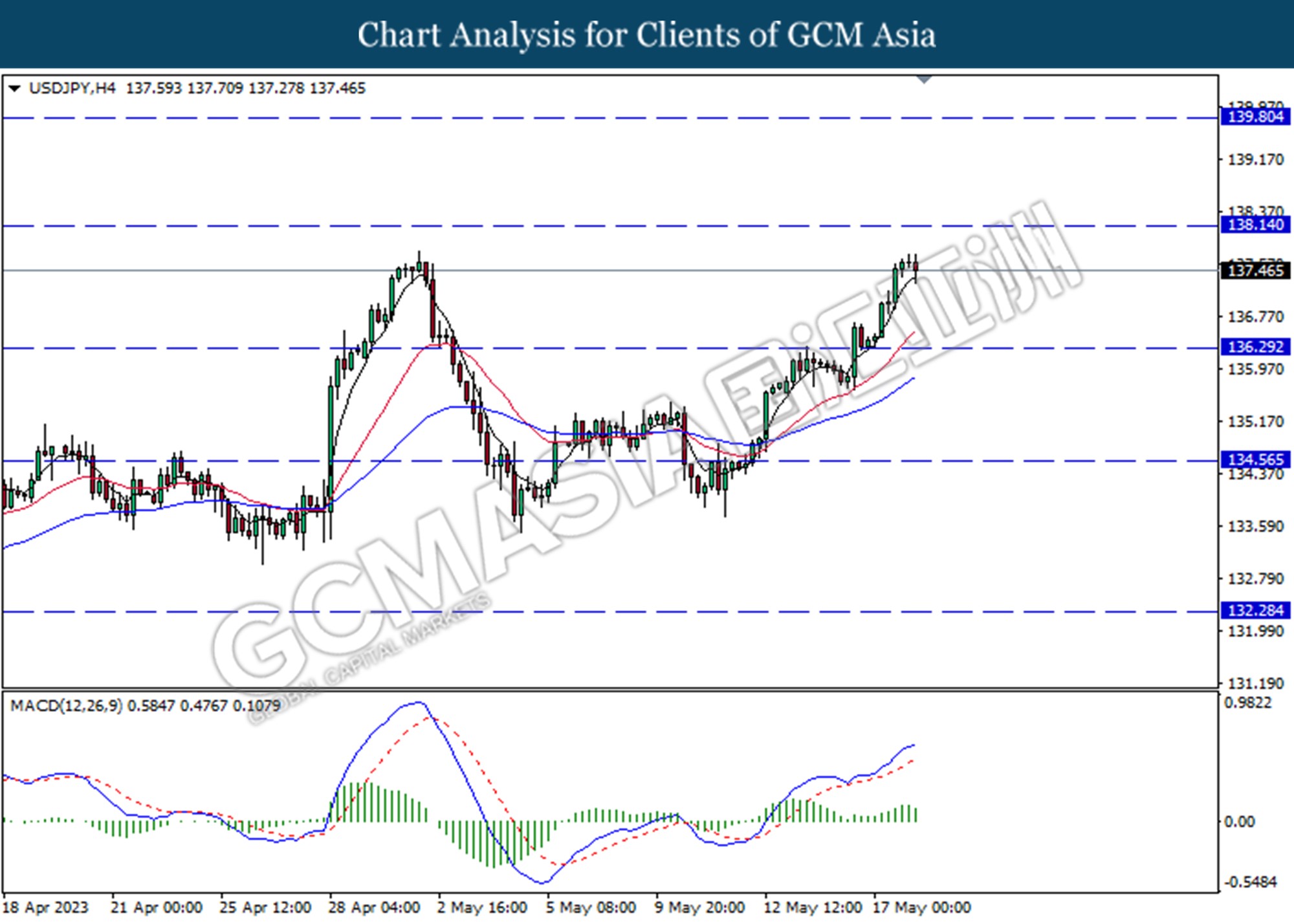

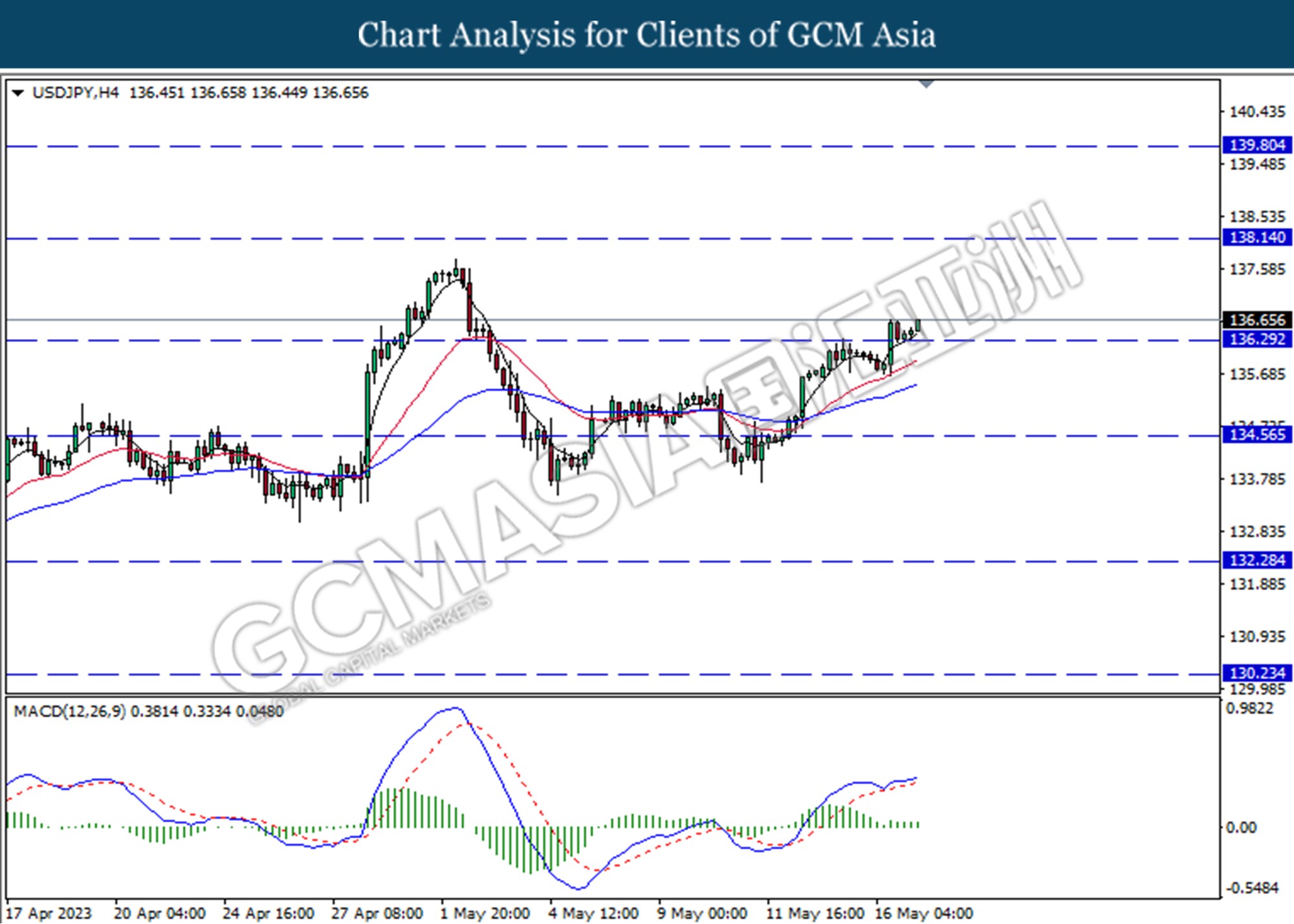

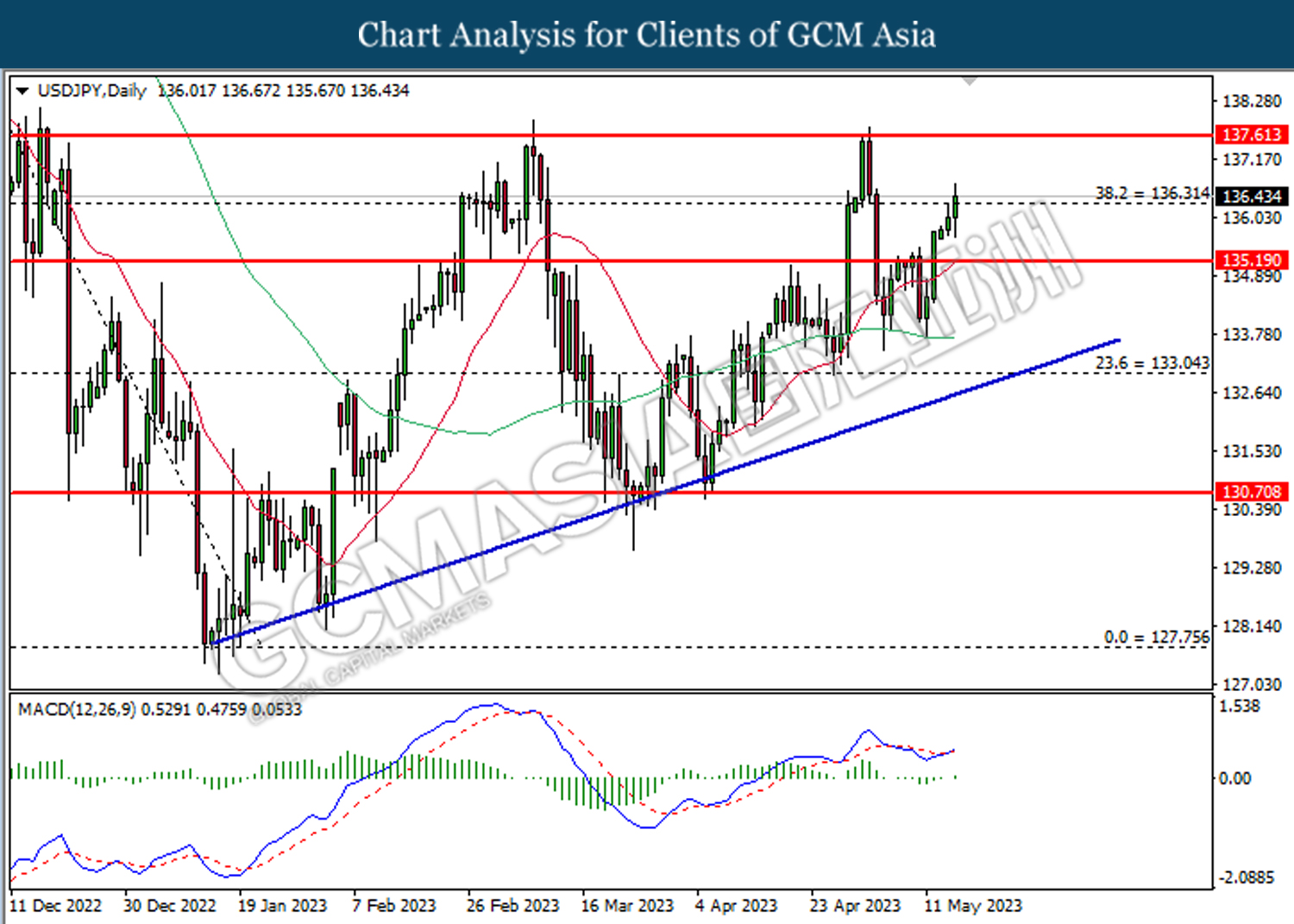

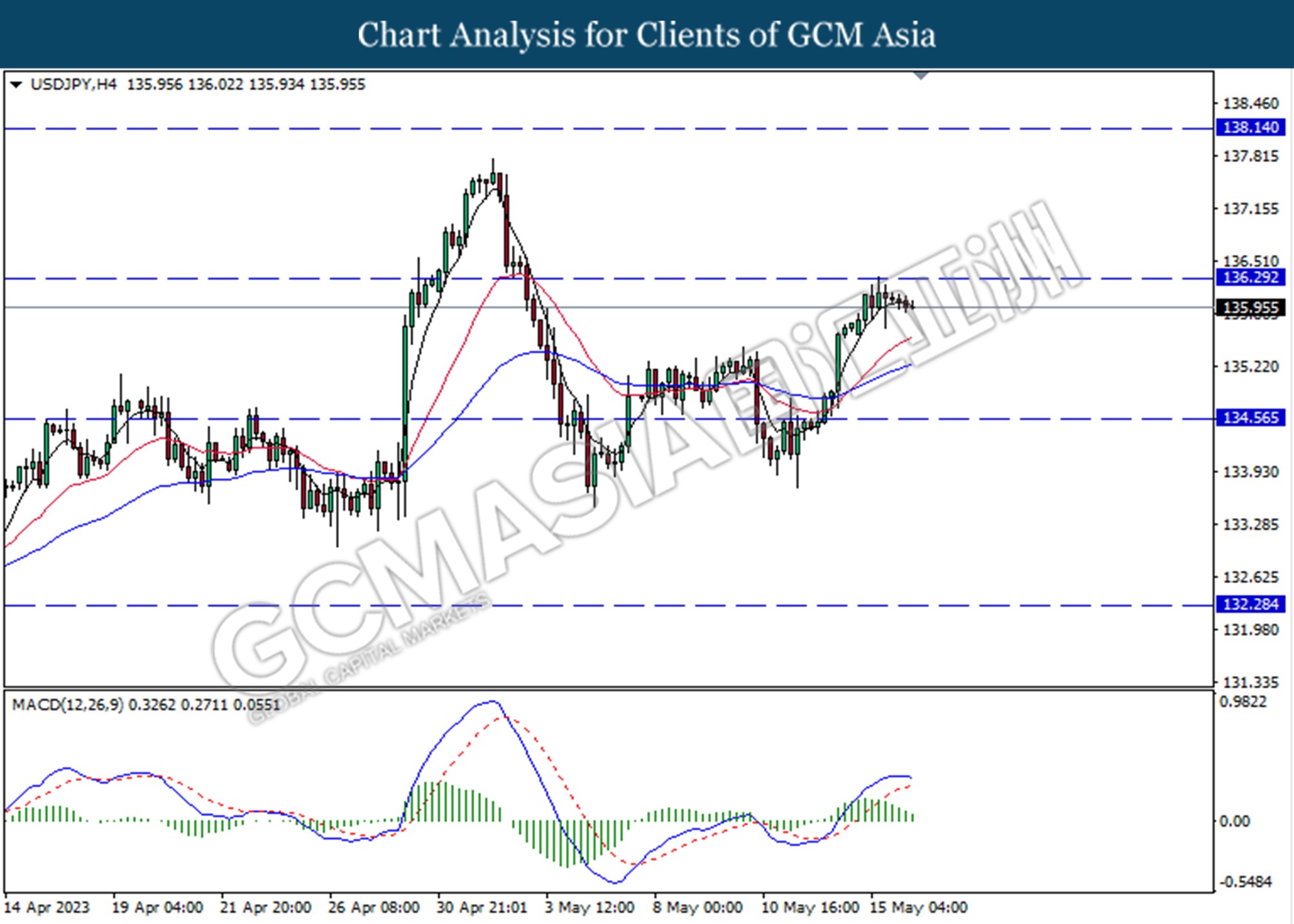

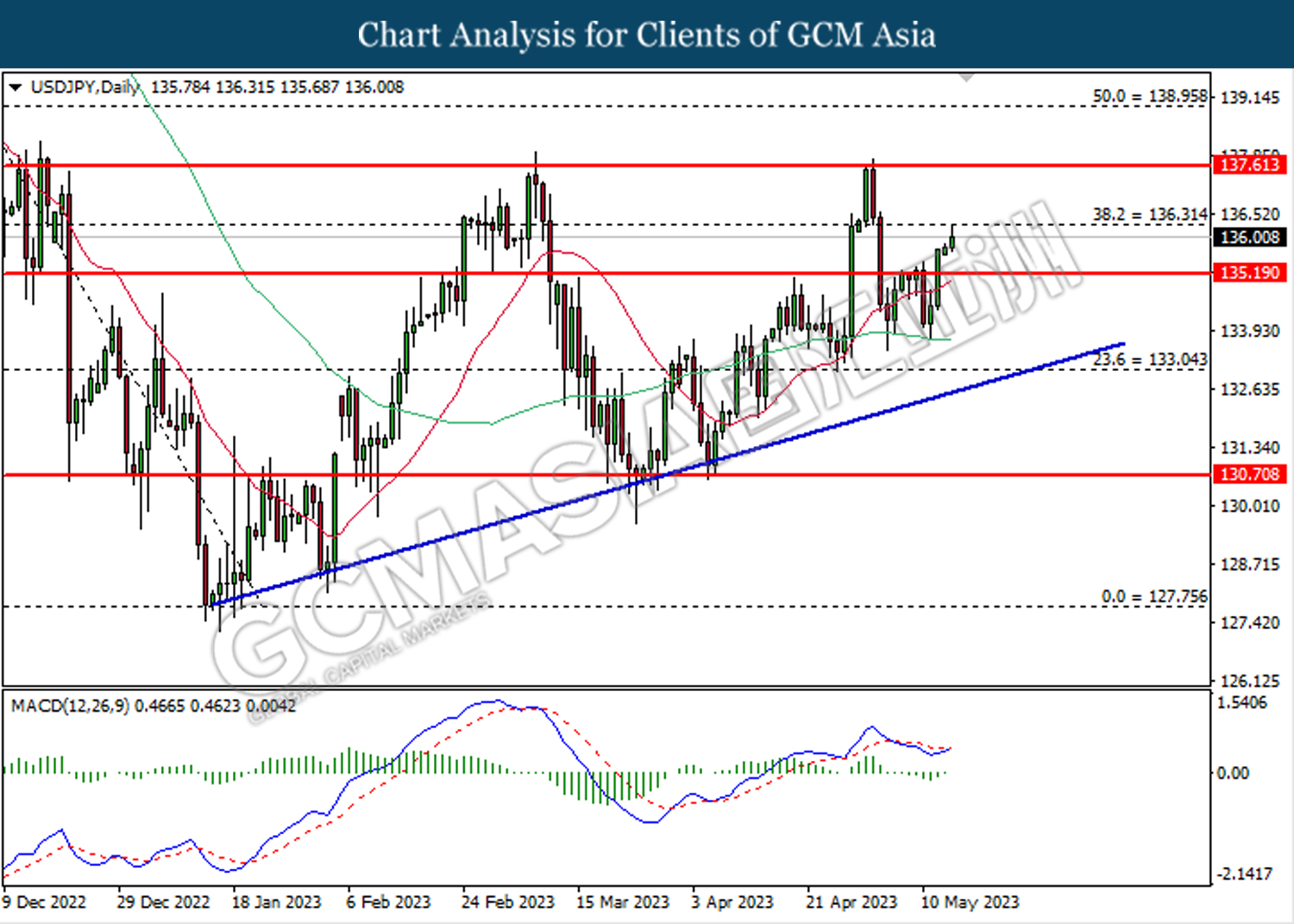

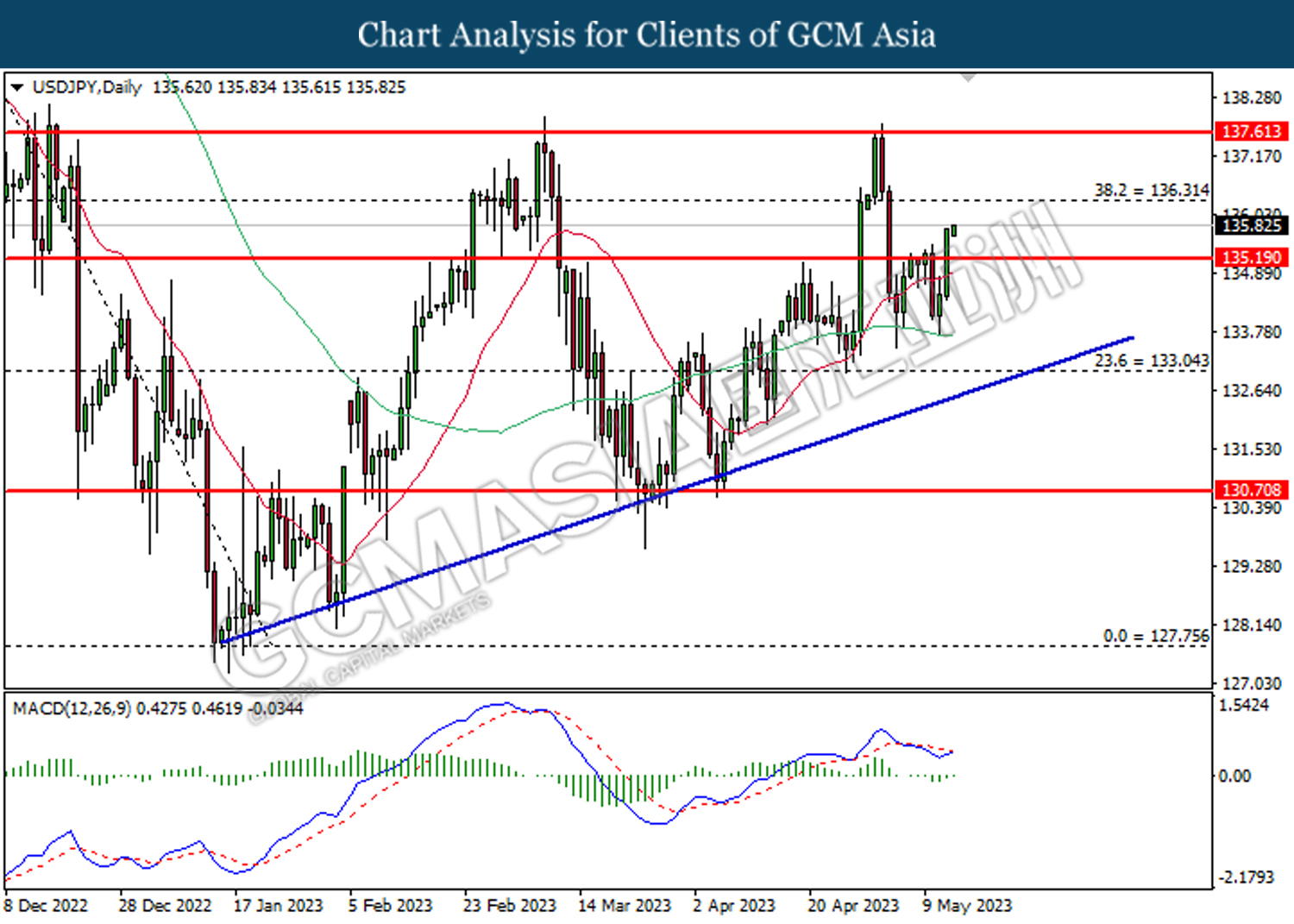

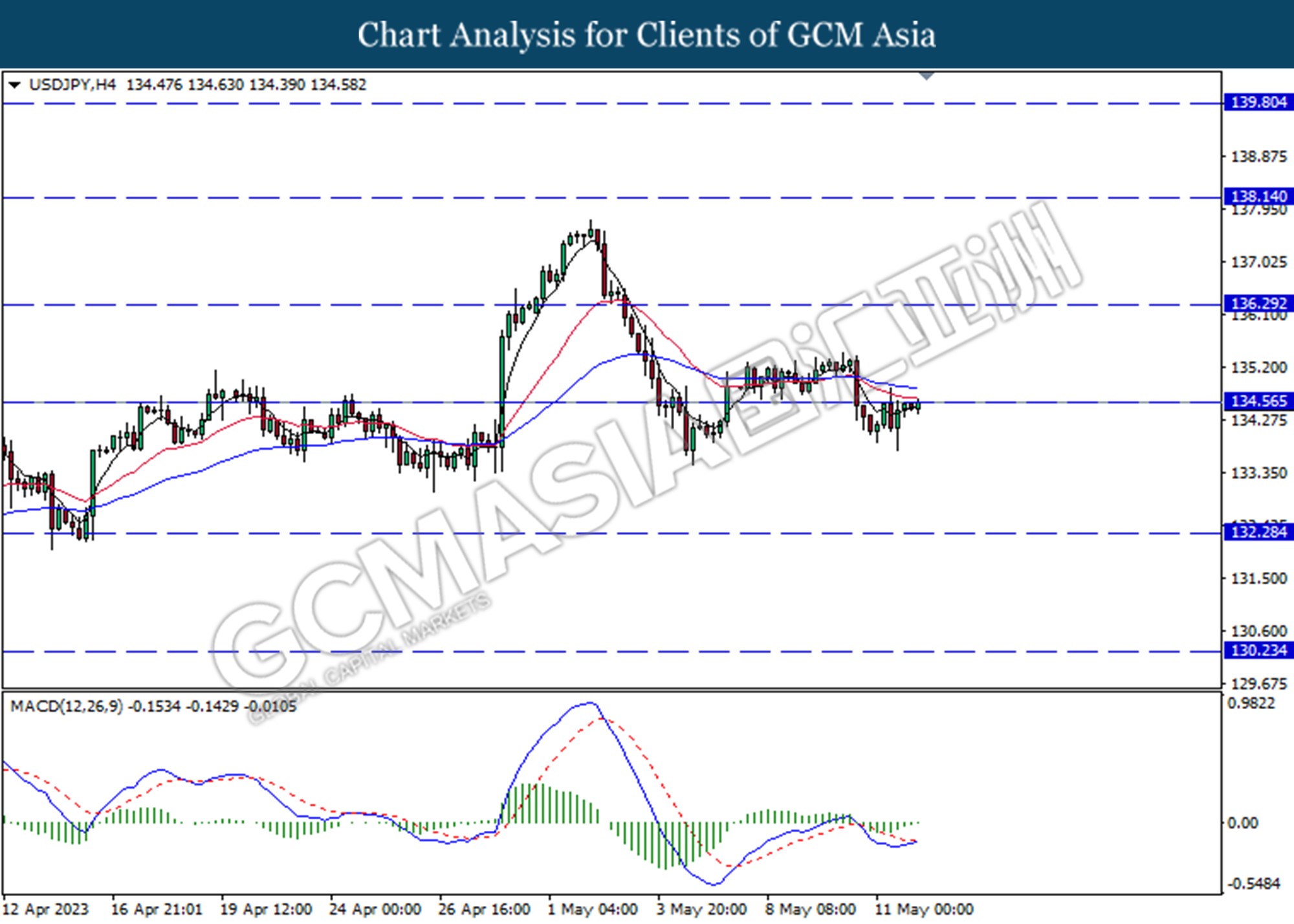

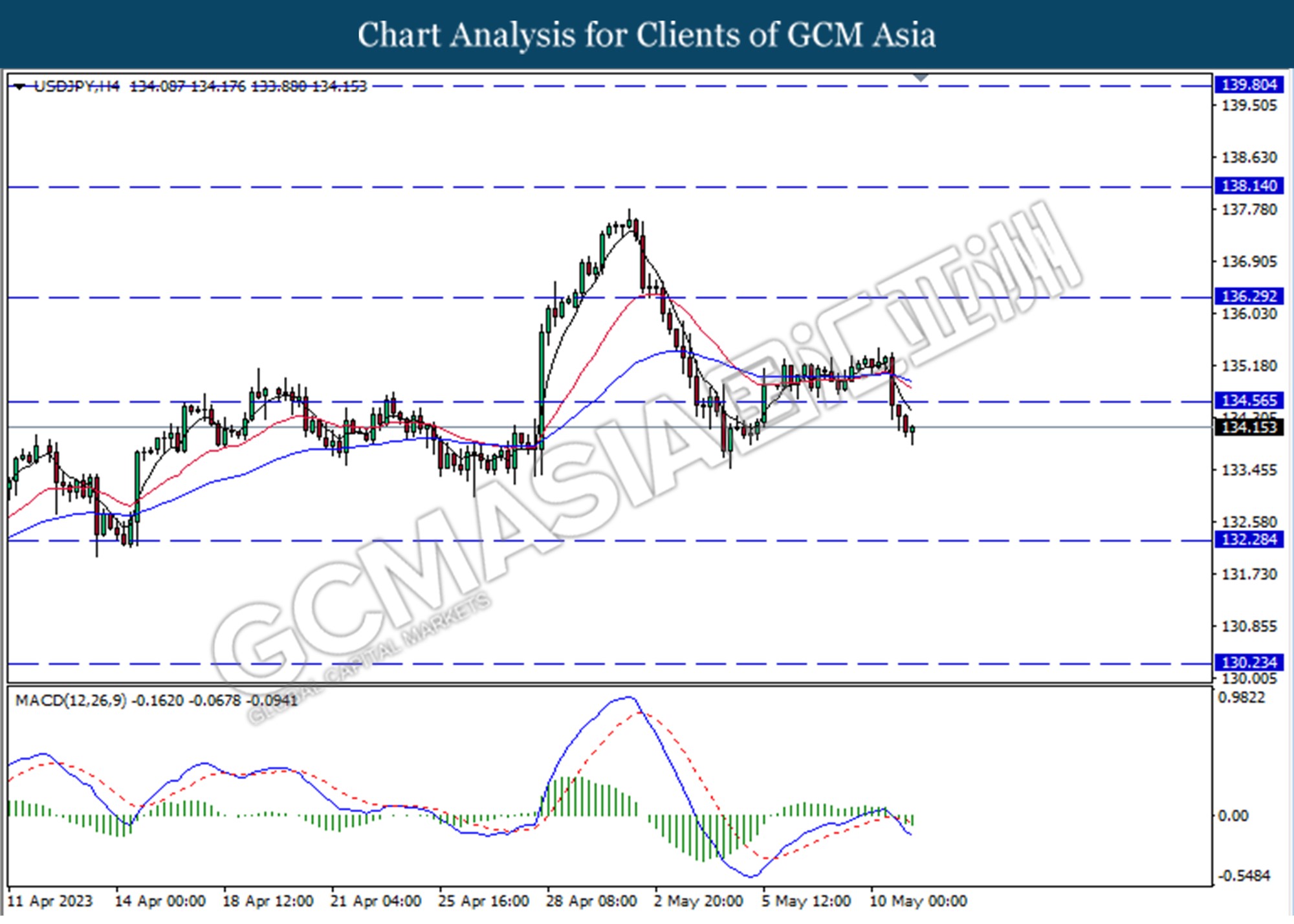

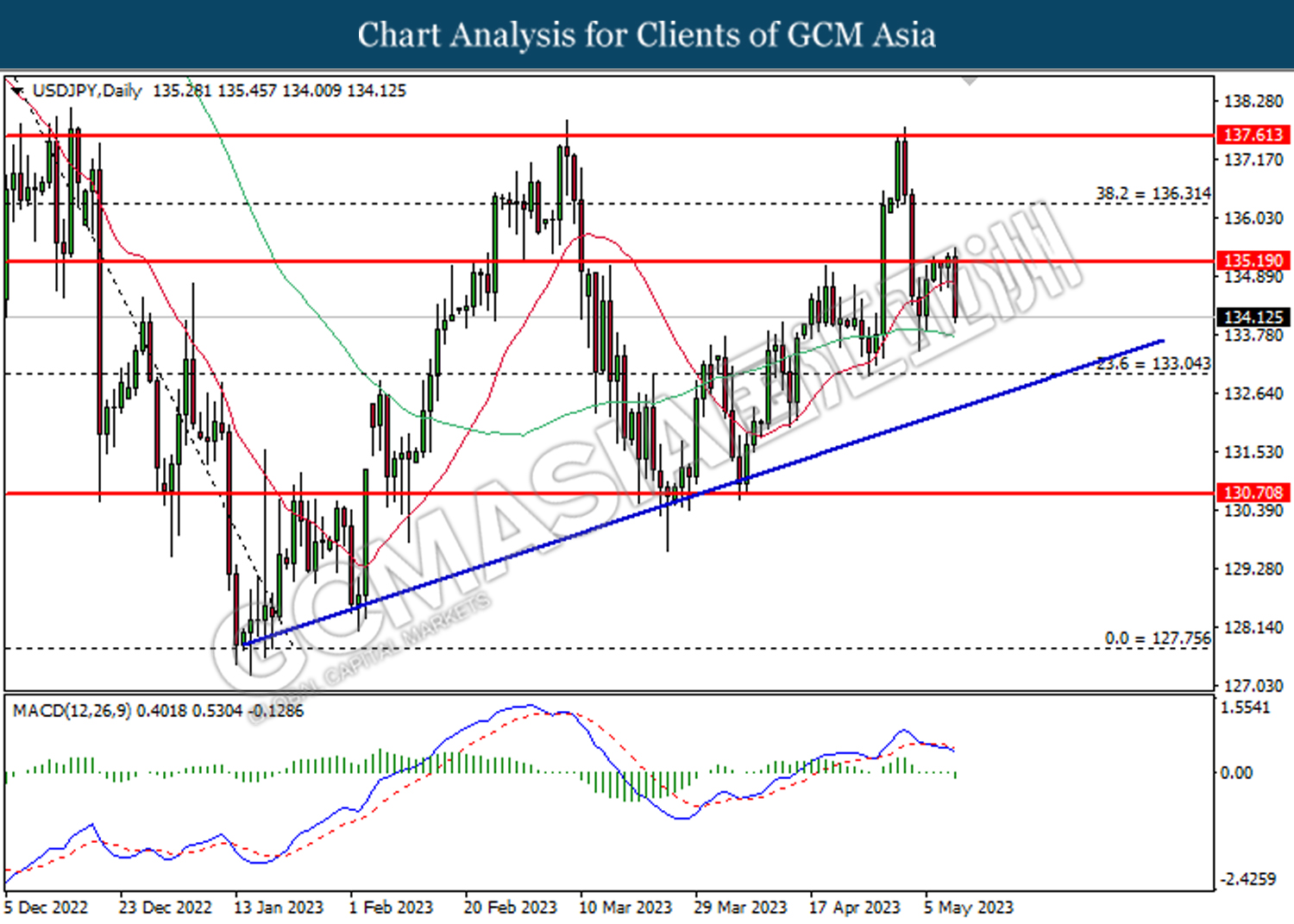

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 138.15.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

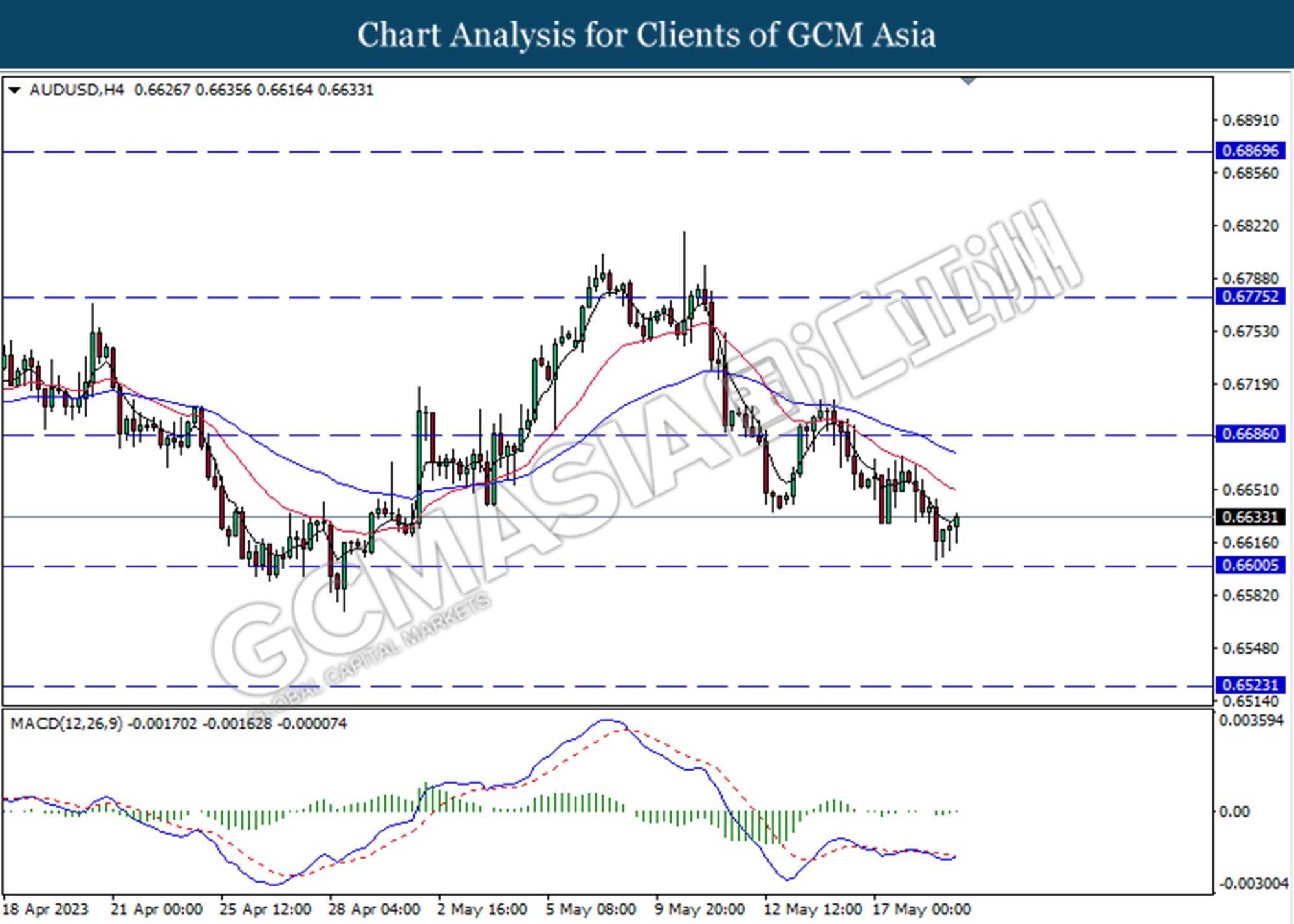

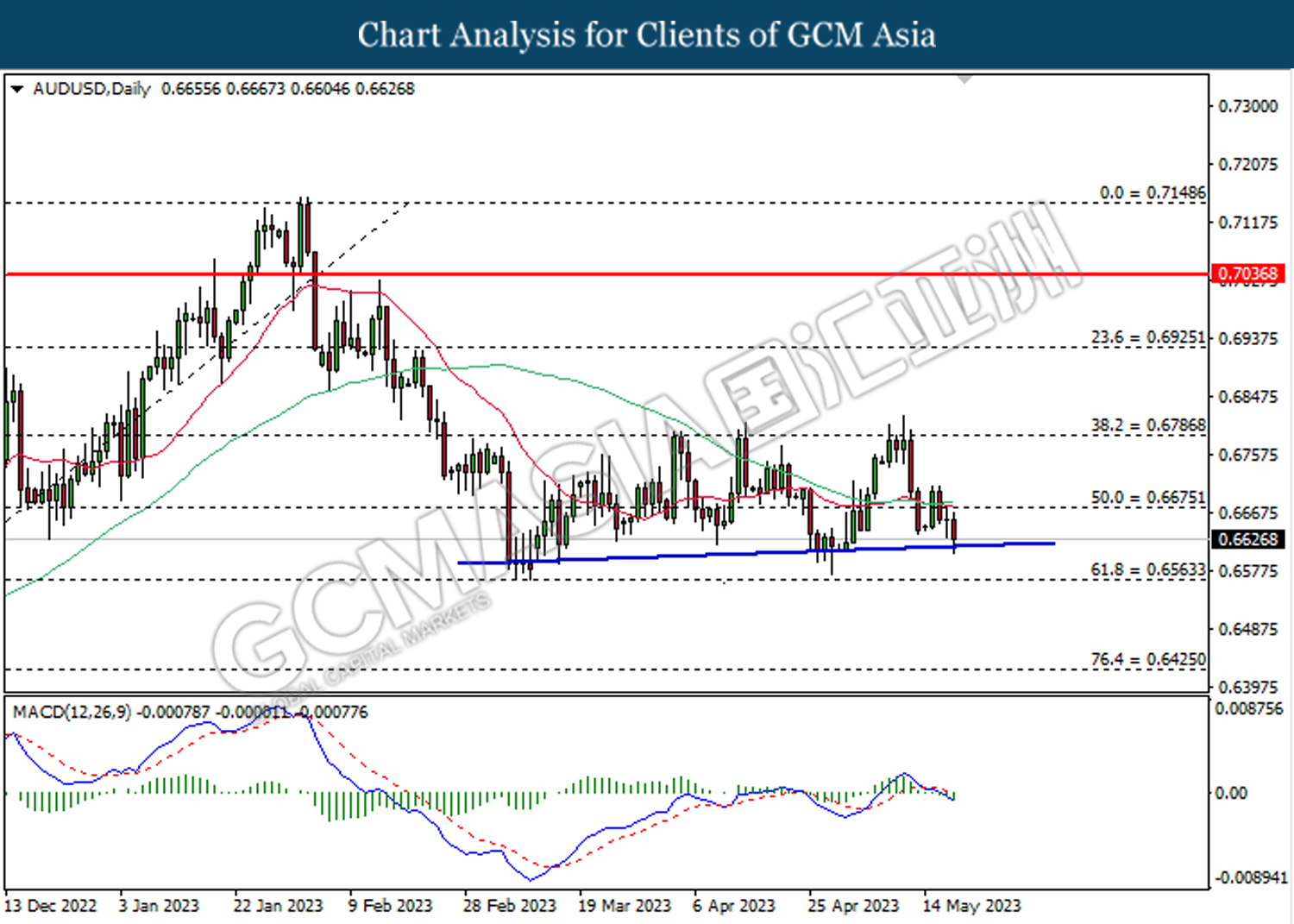

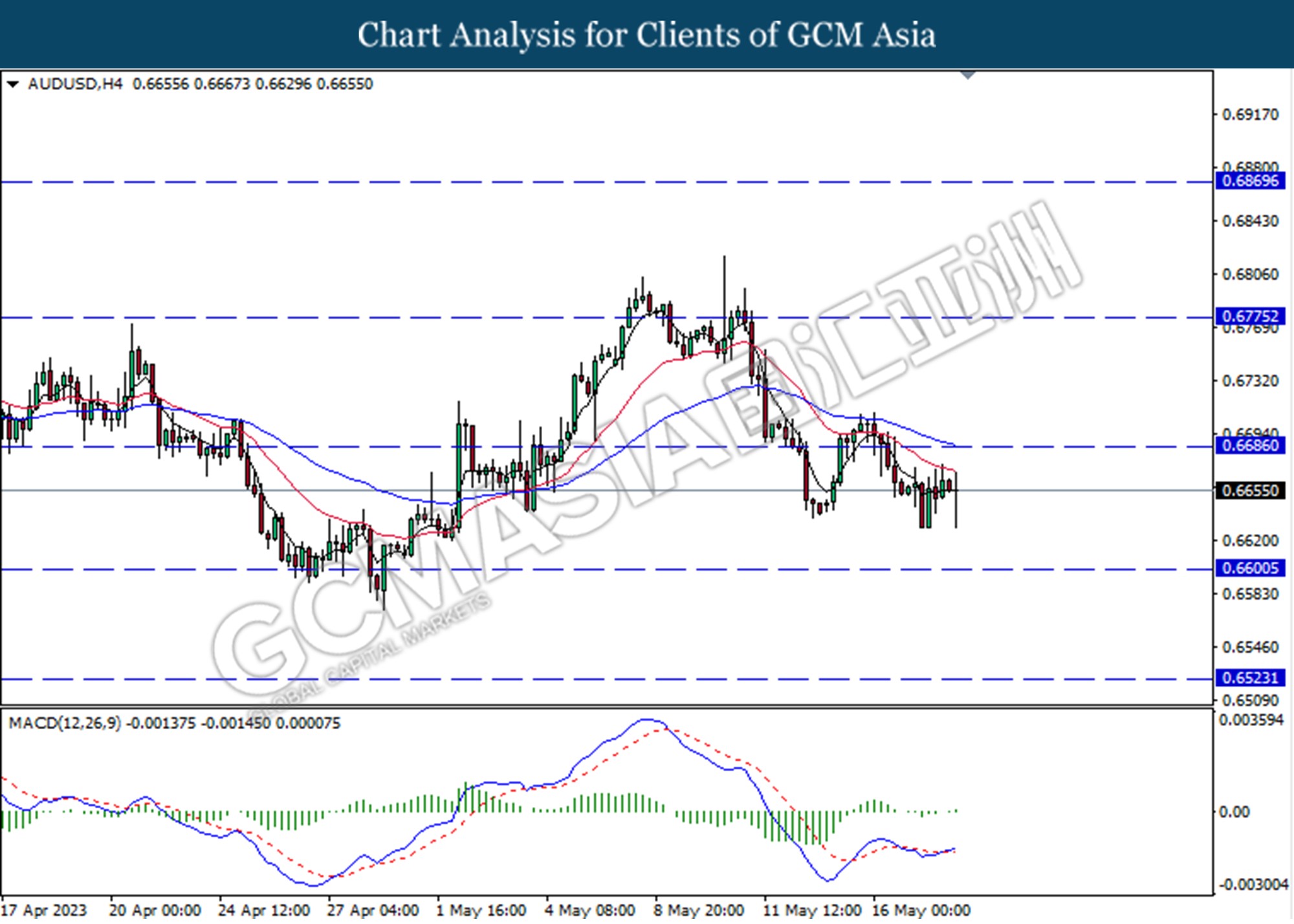

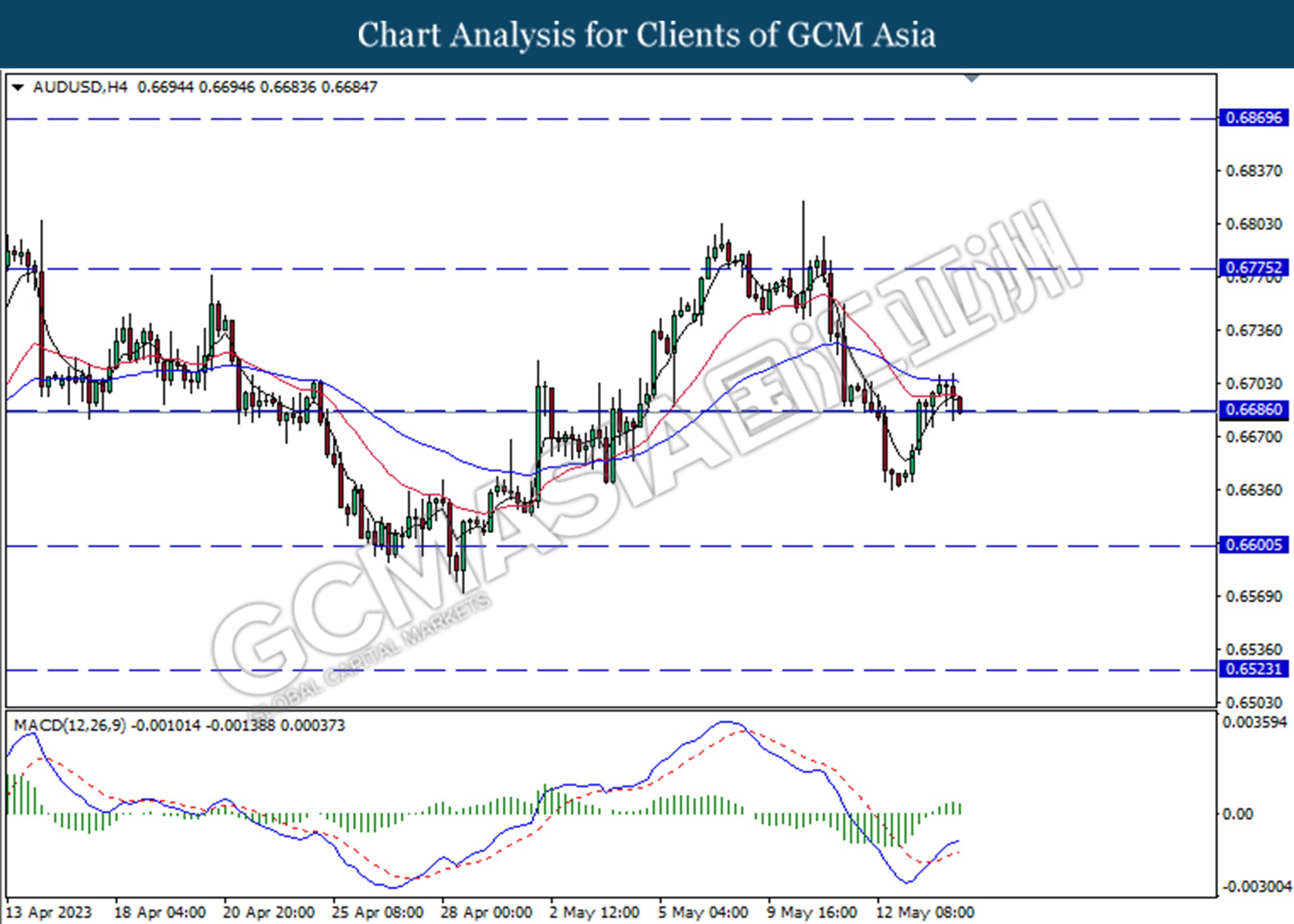

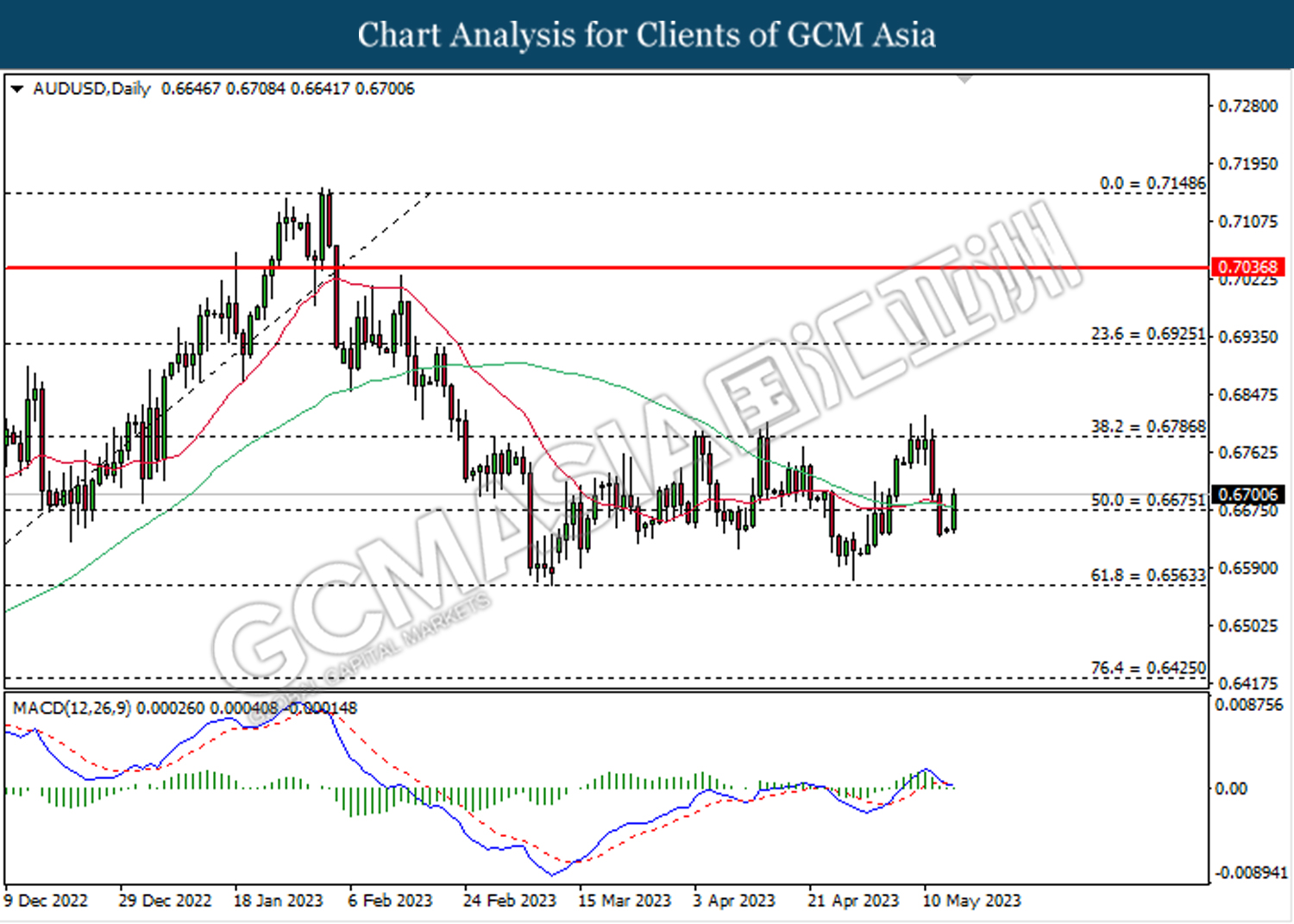

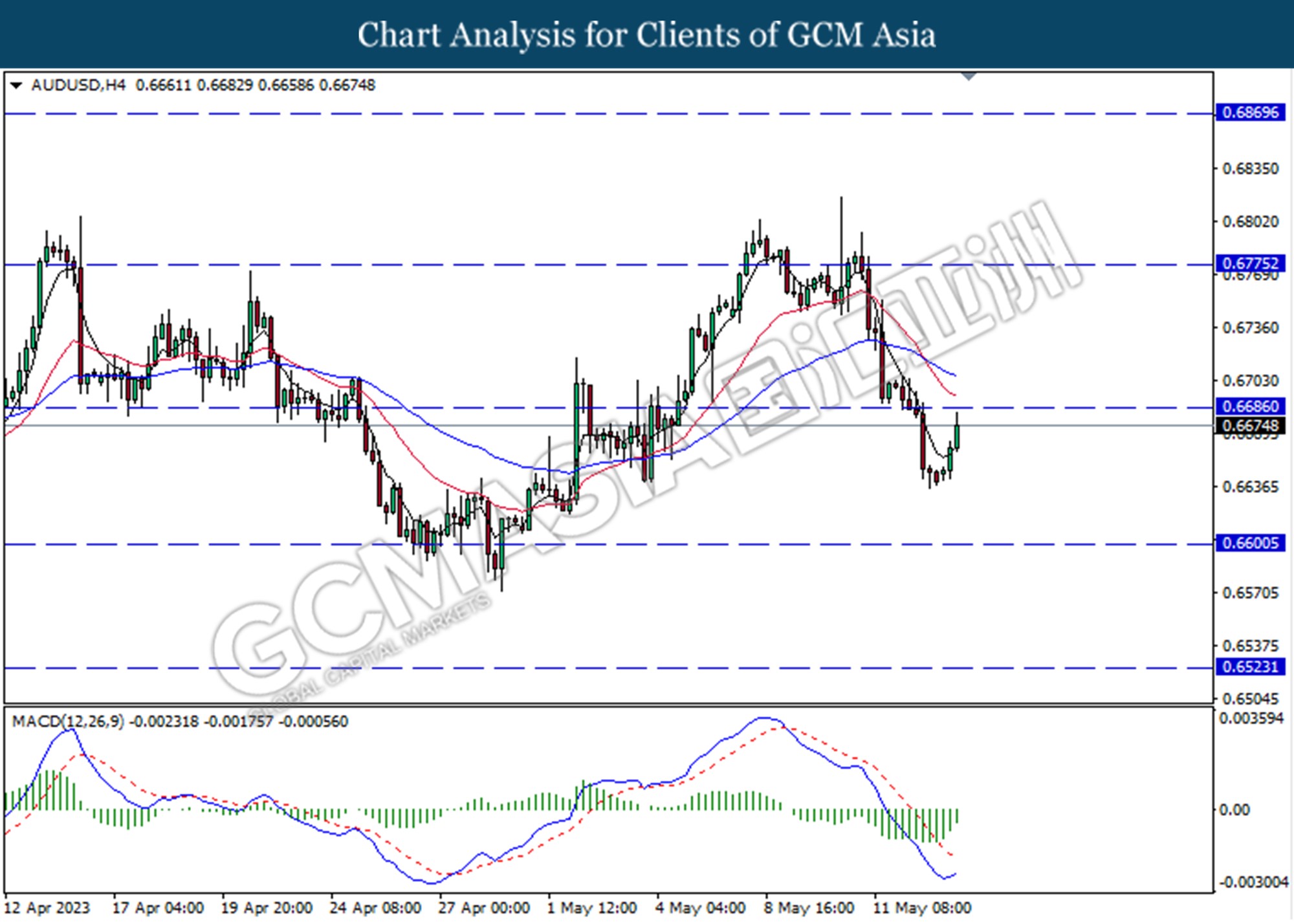

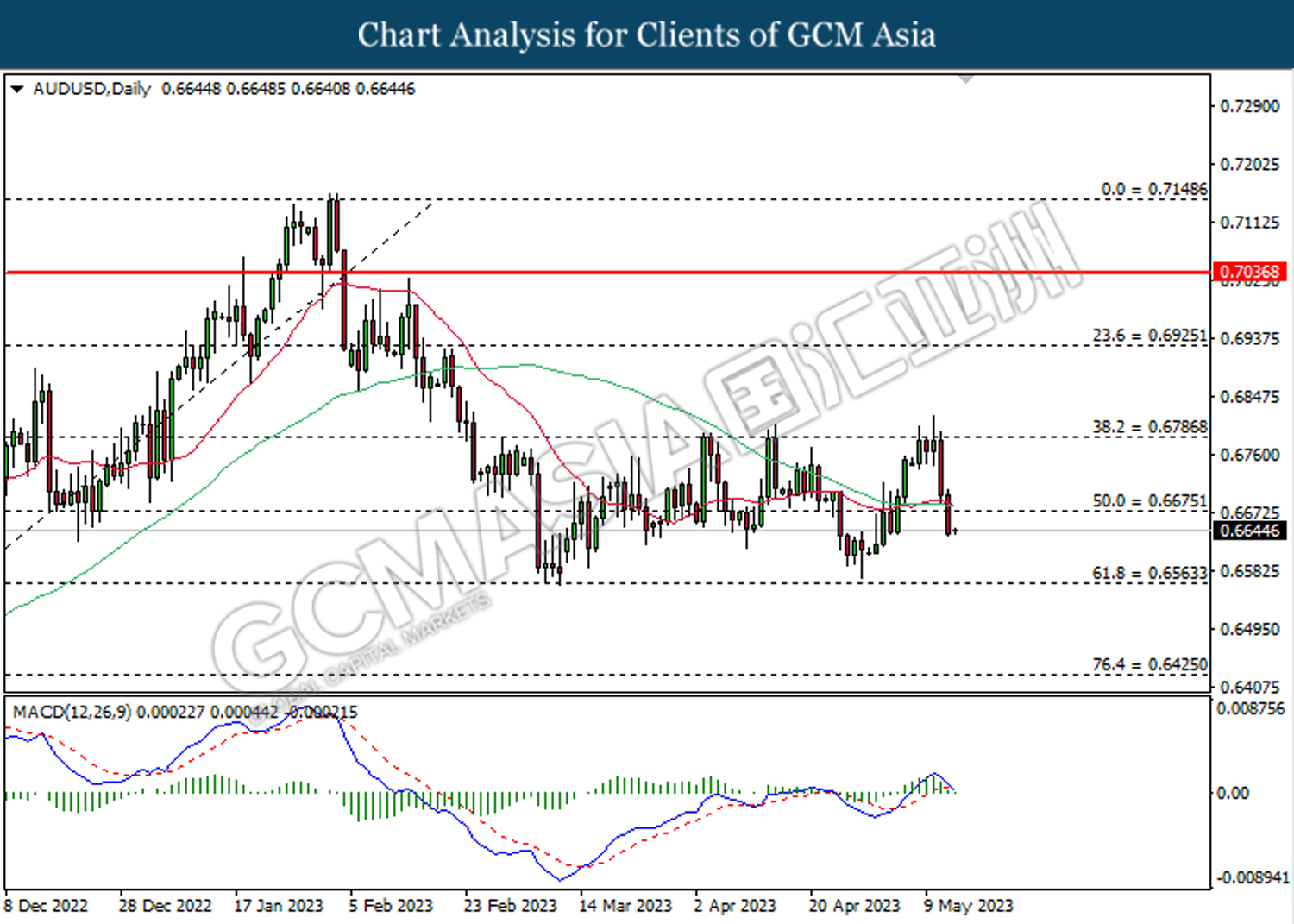

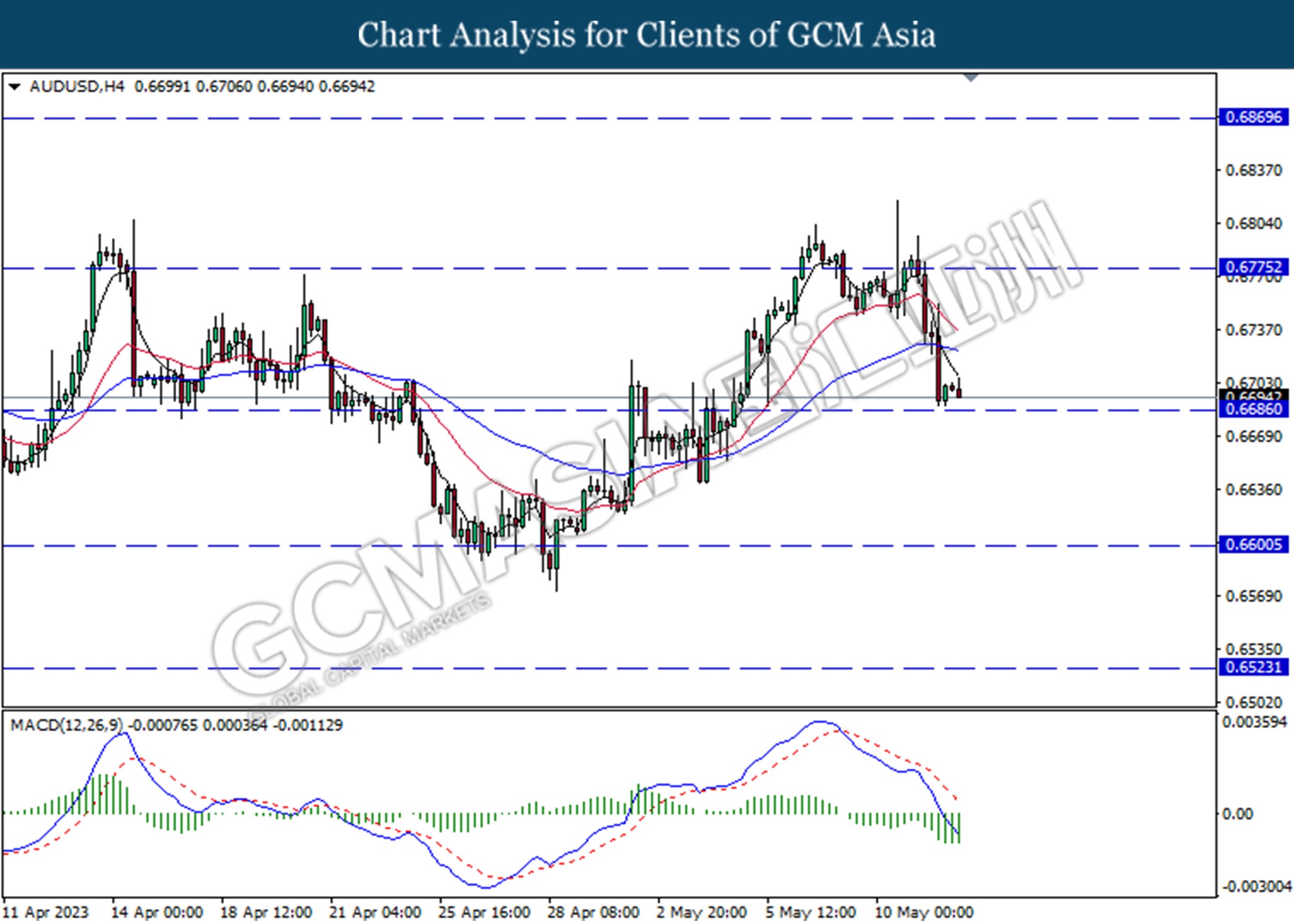

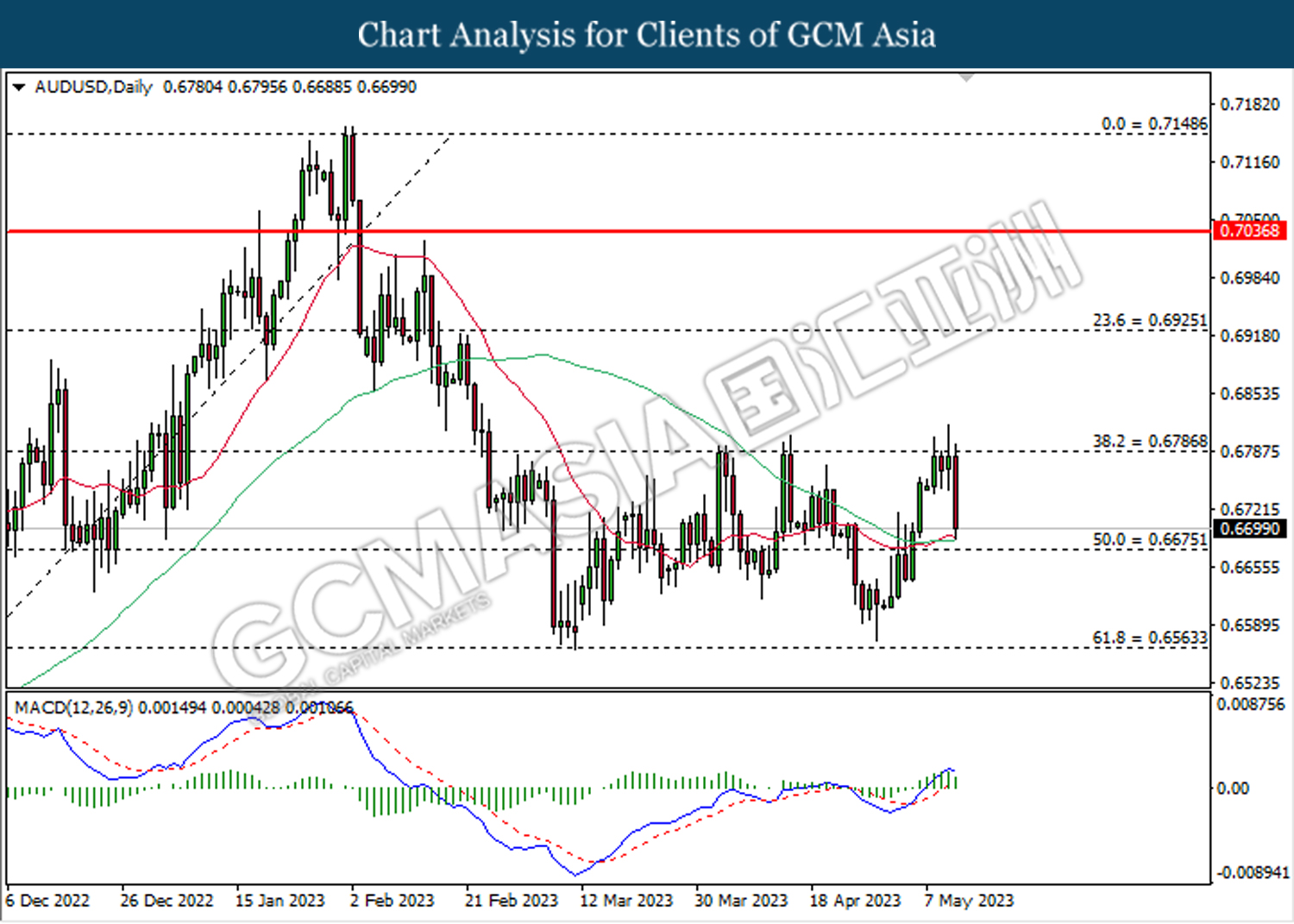

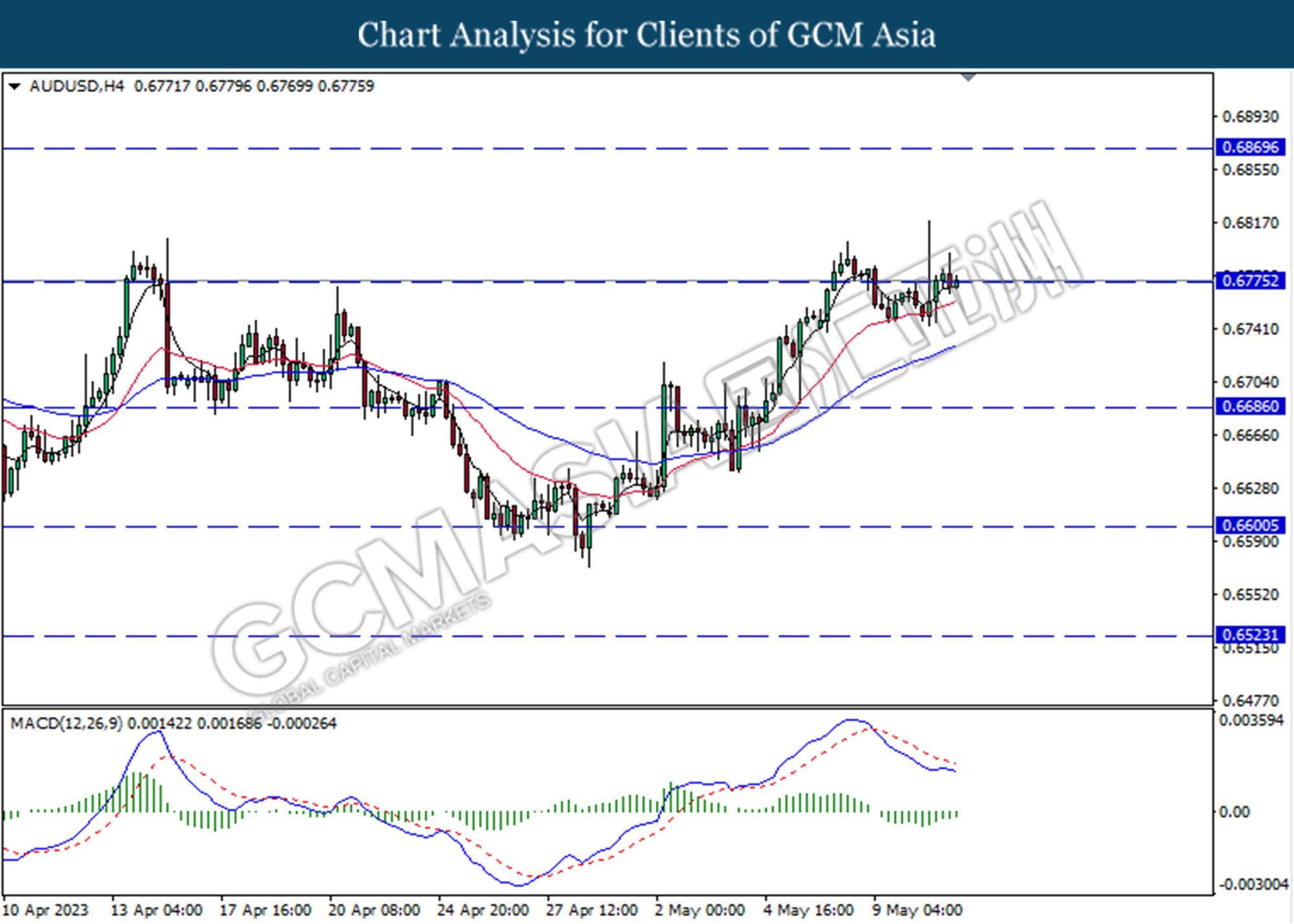

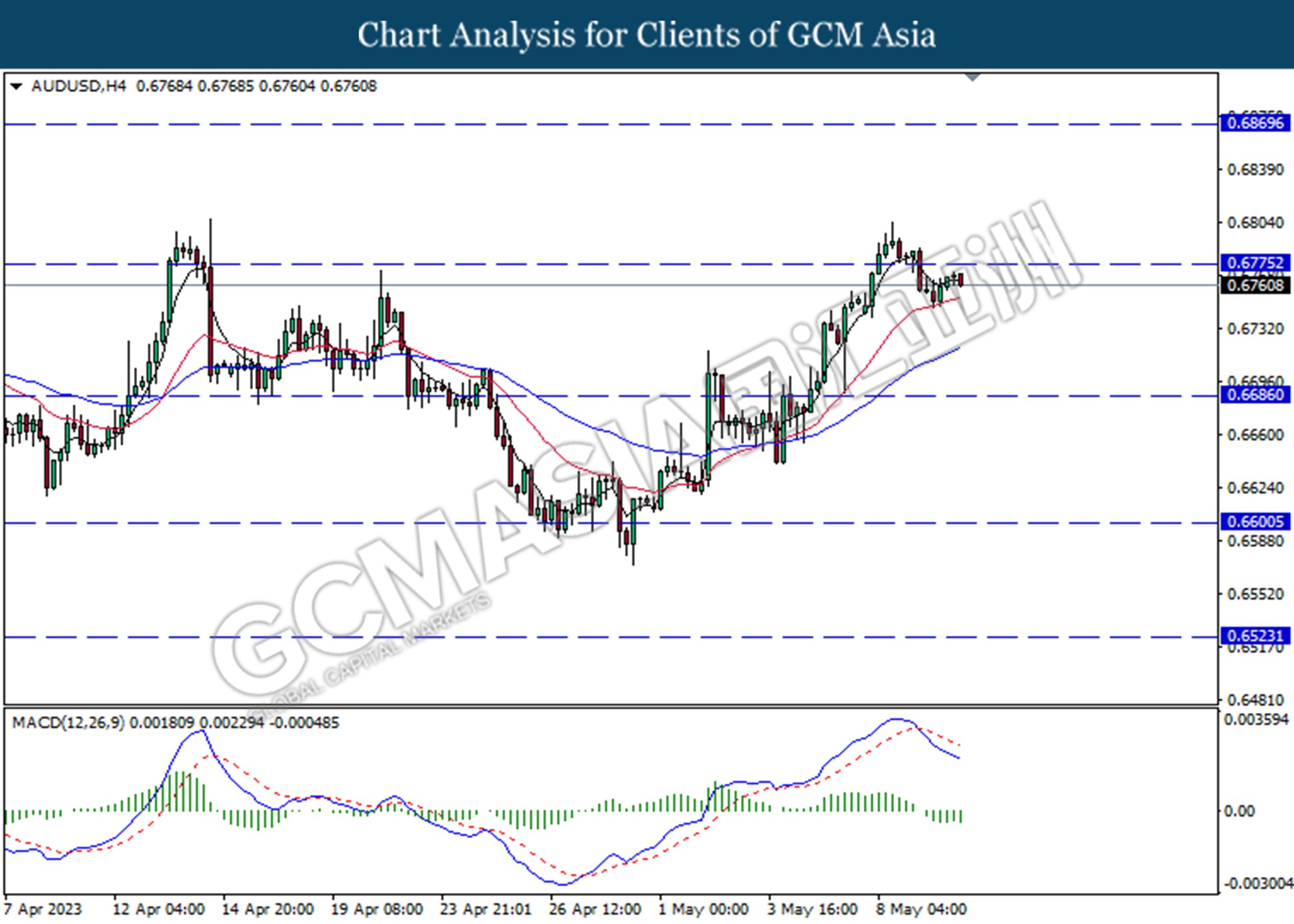

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6600. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

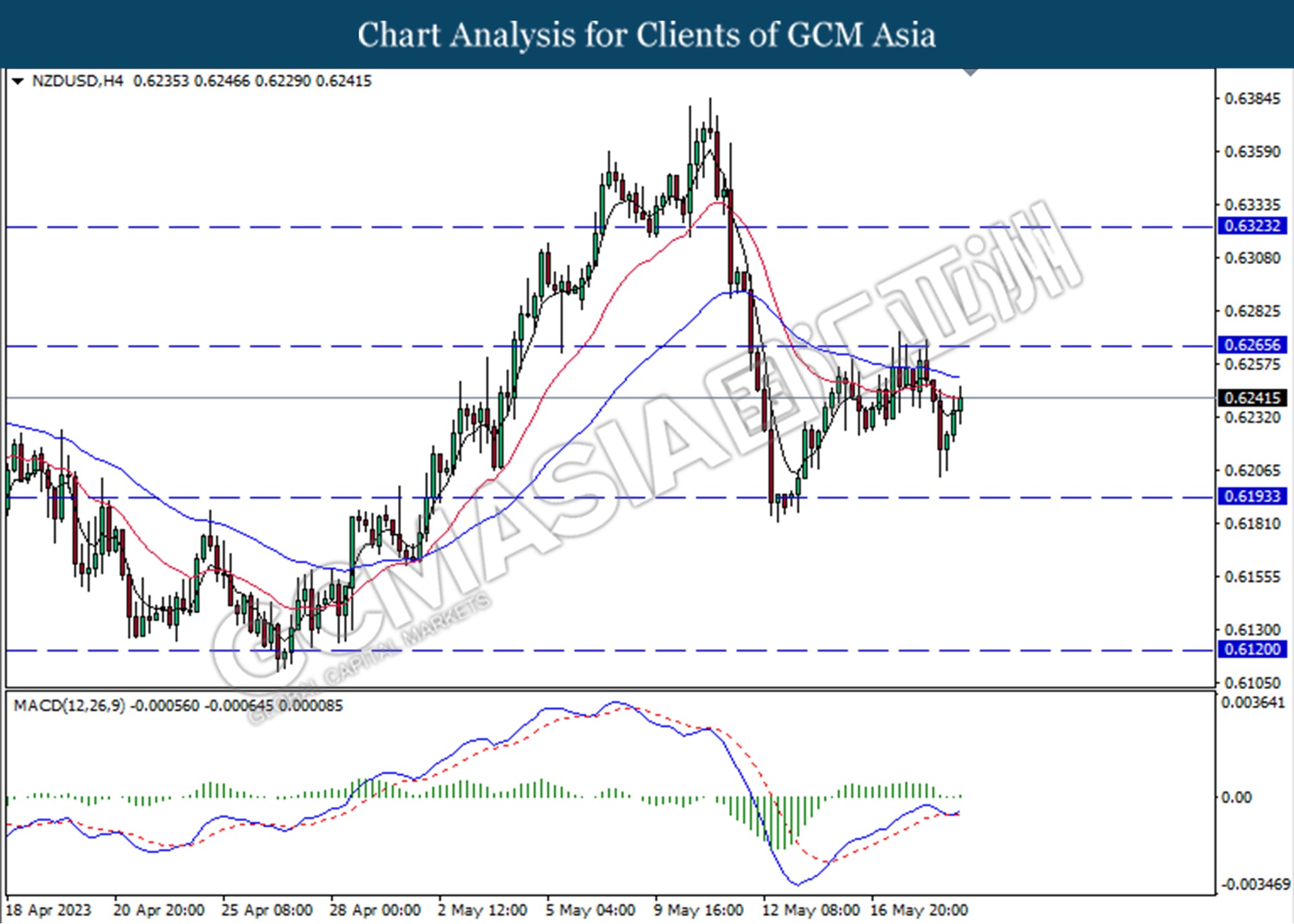

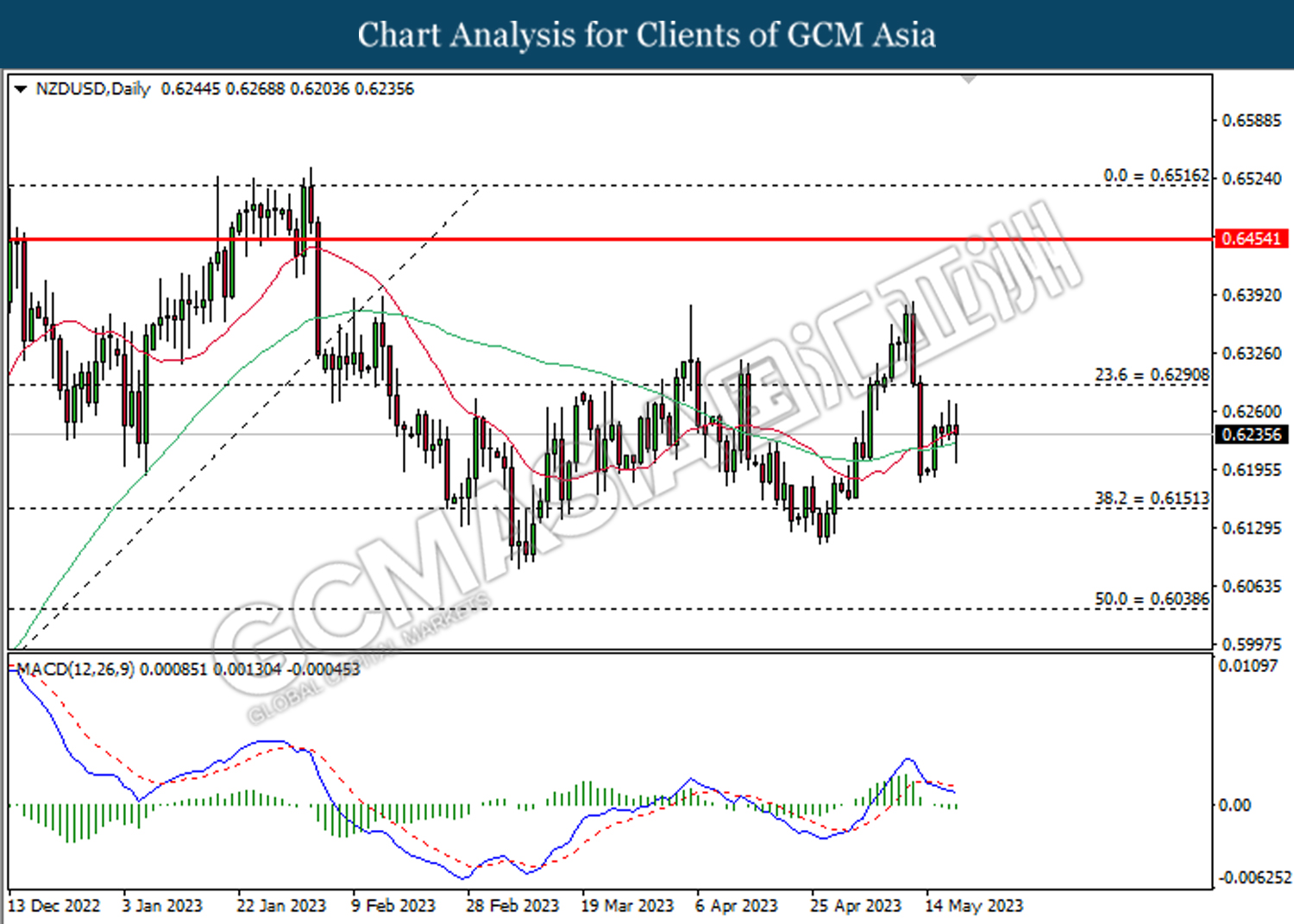

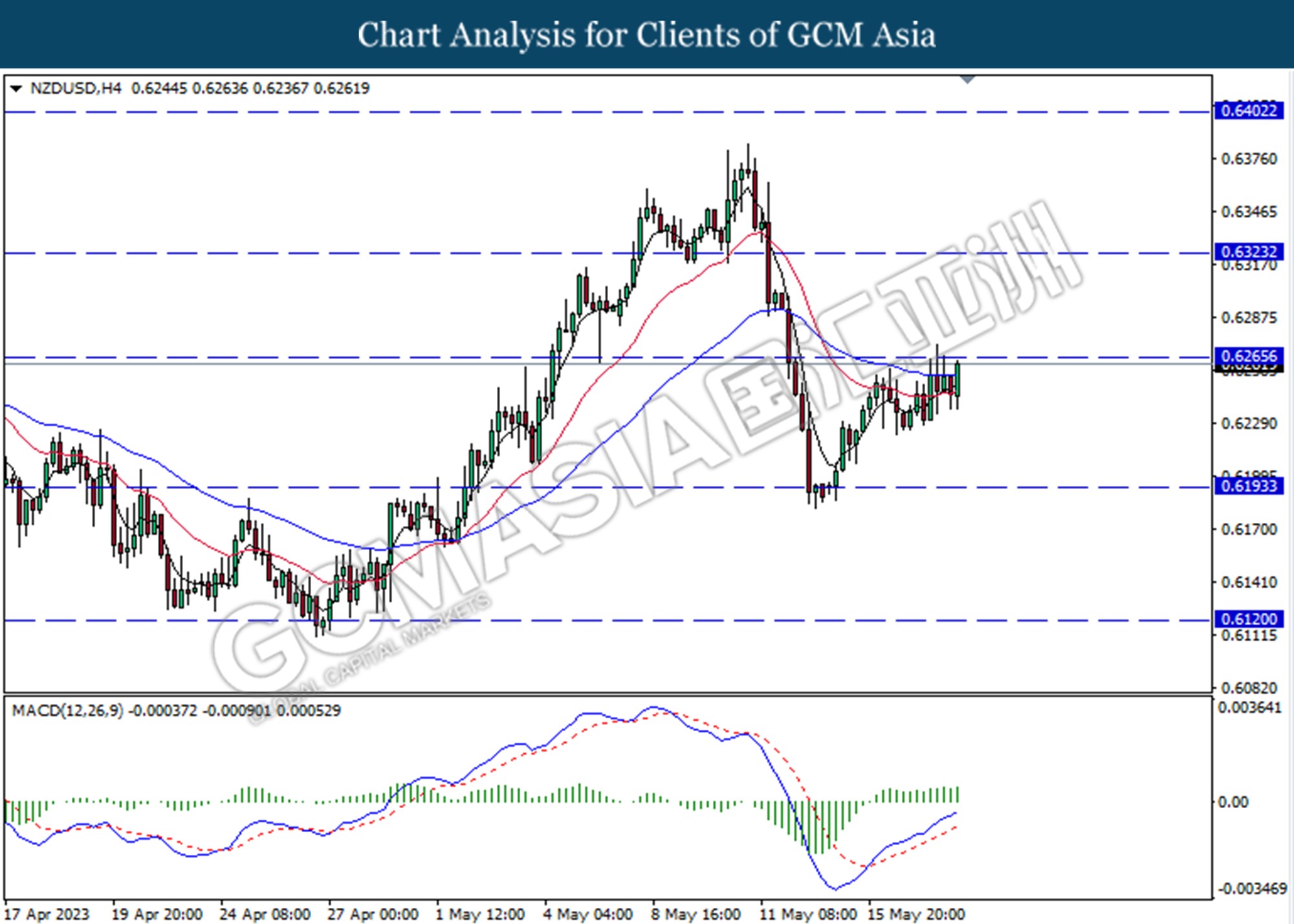

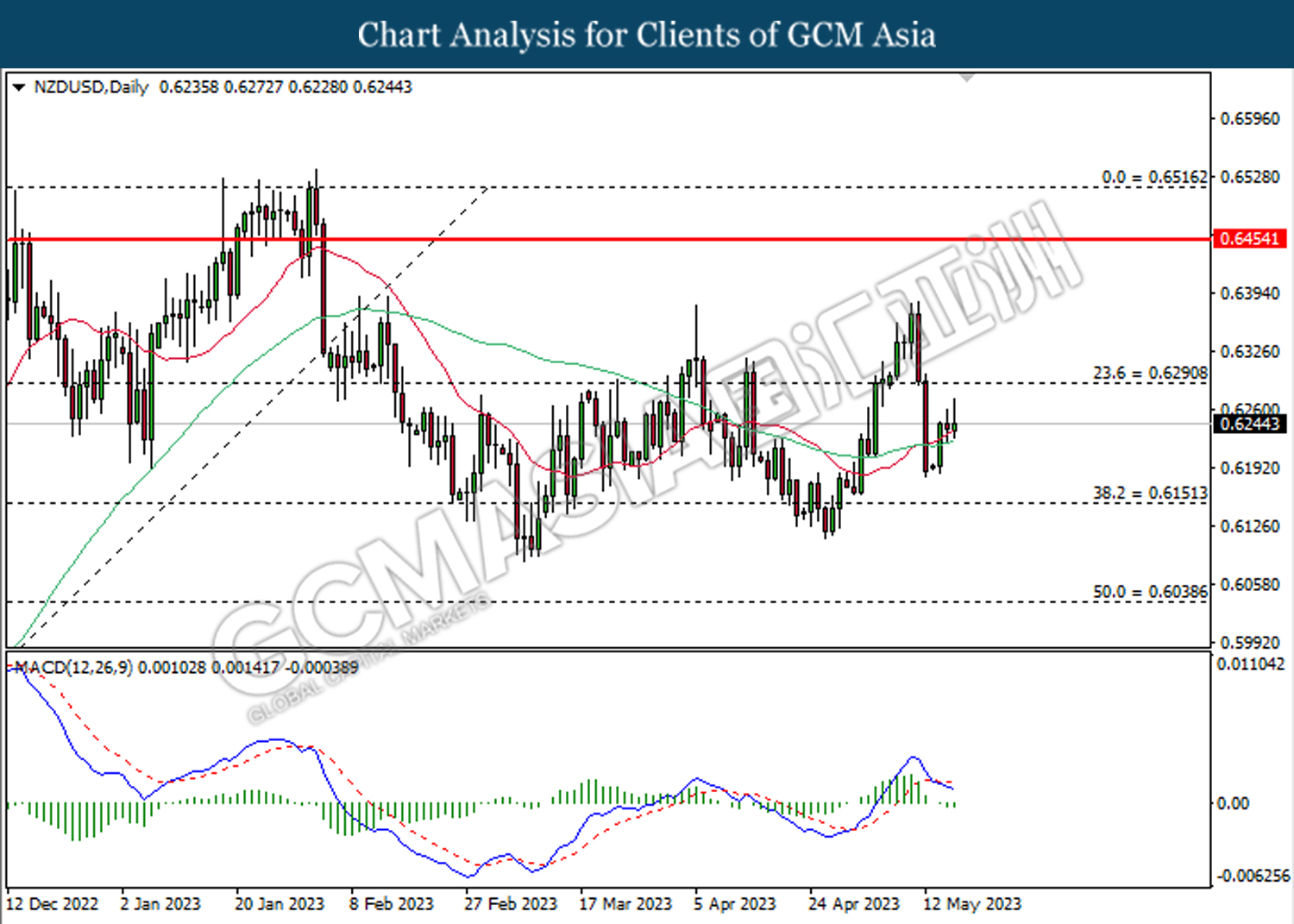

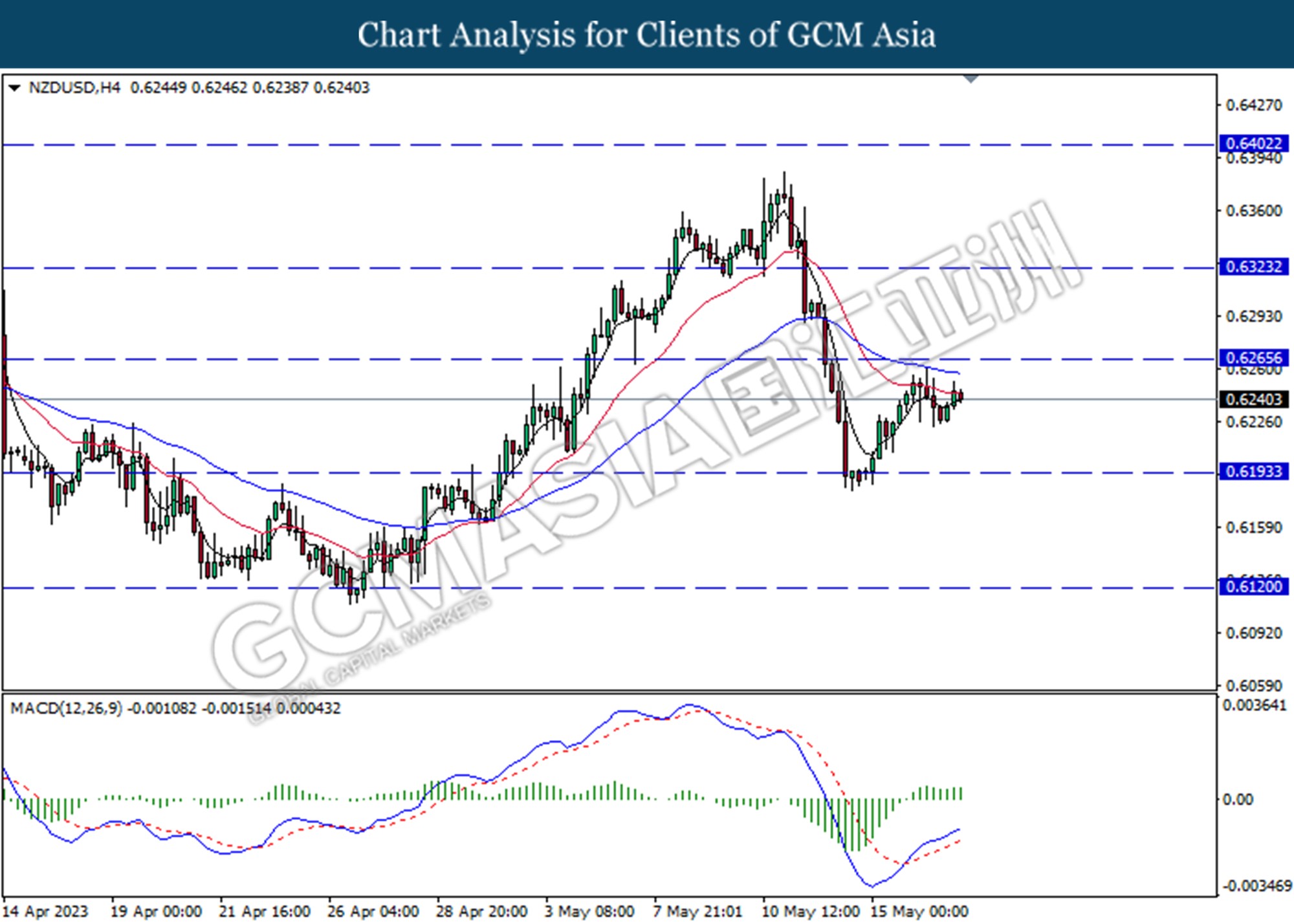

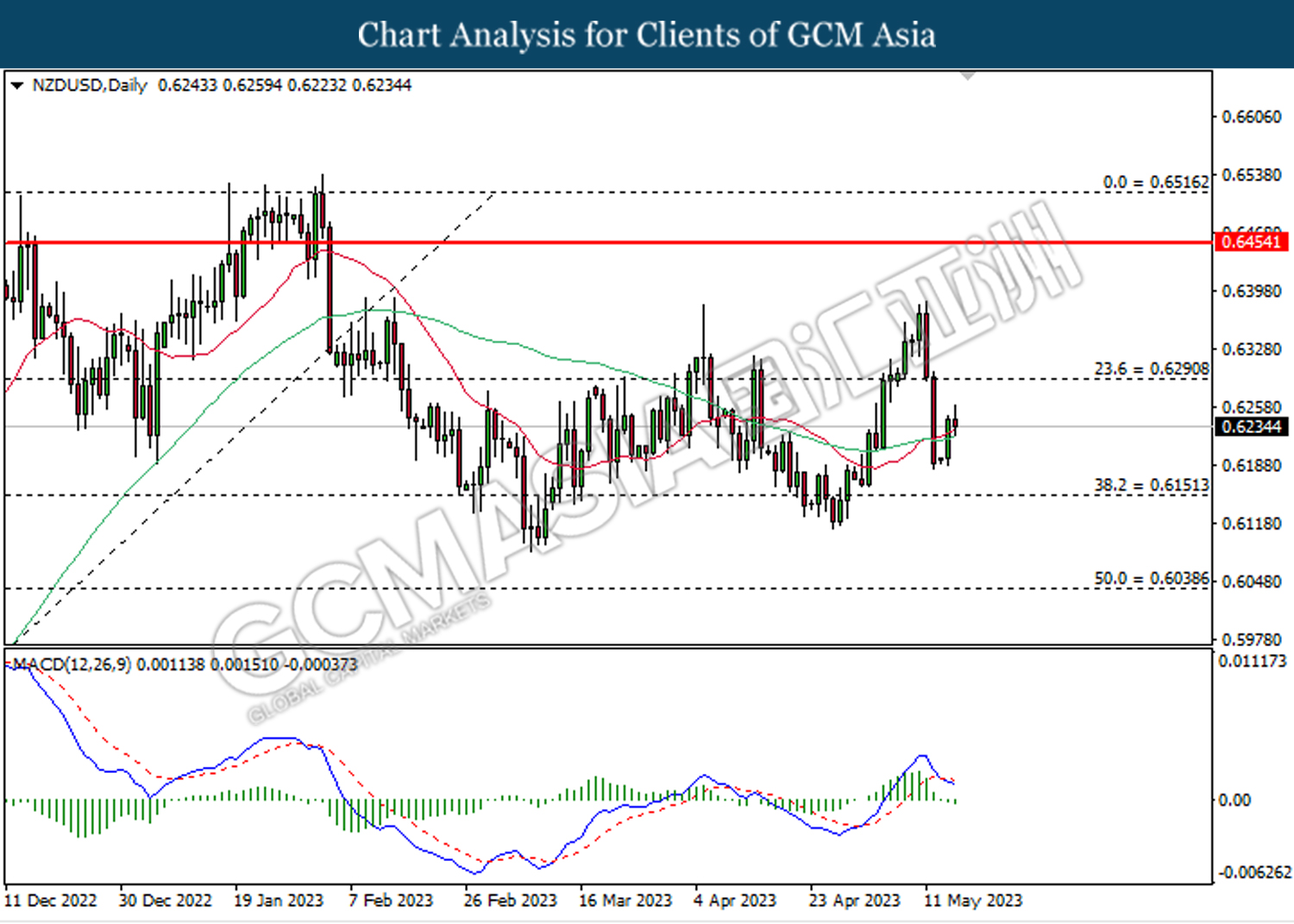

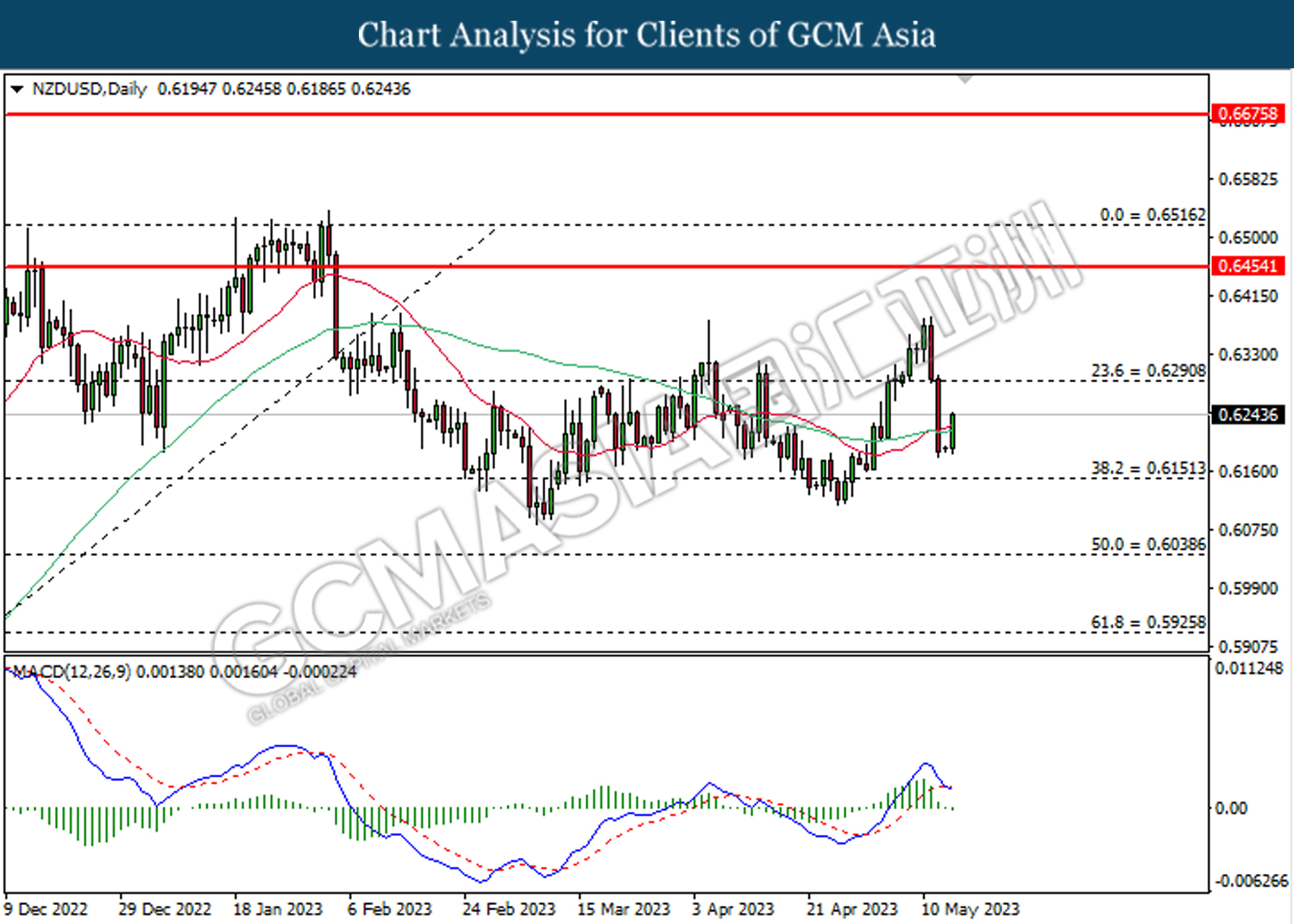

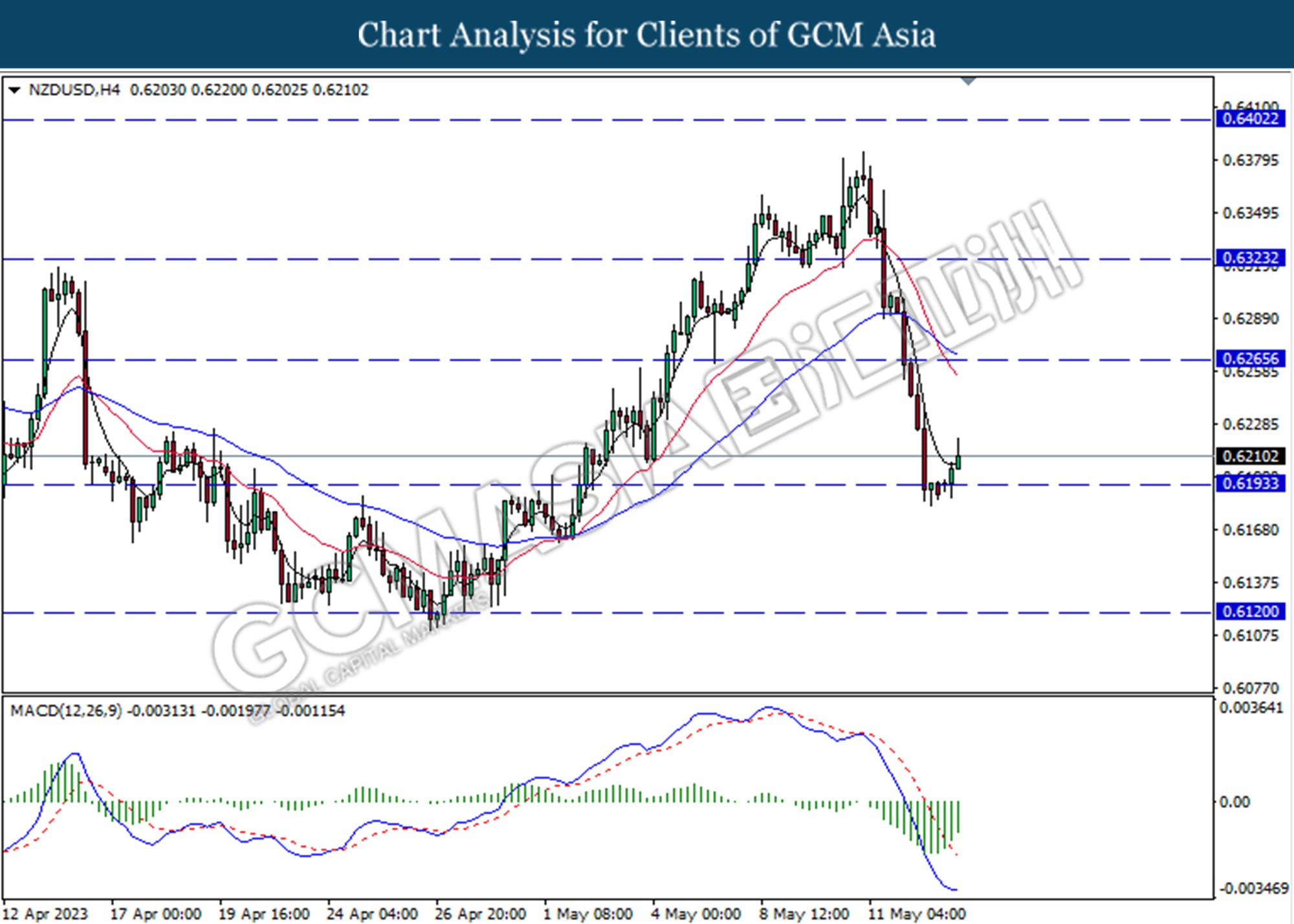

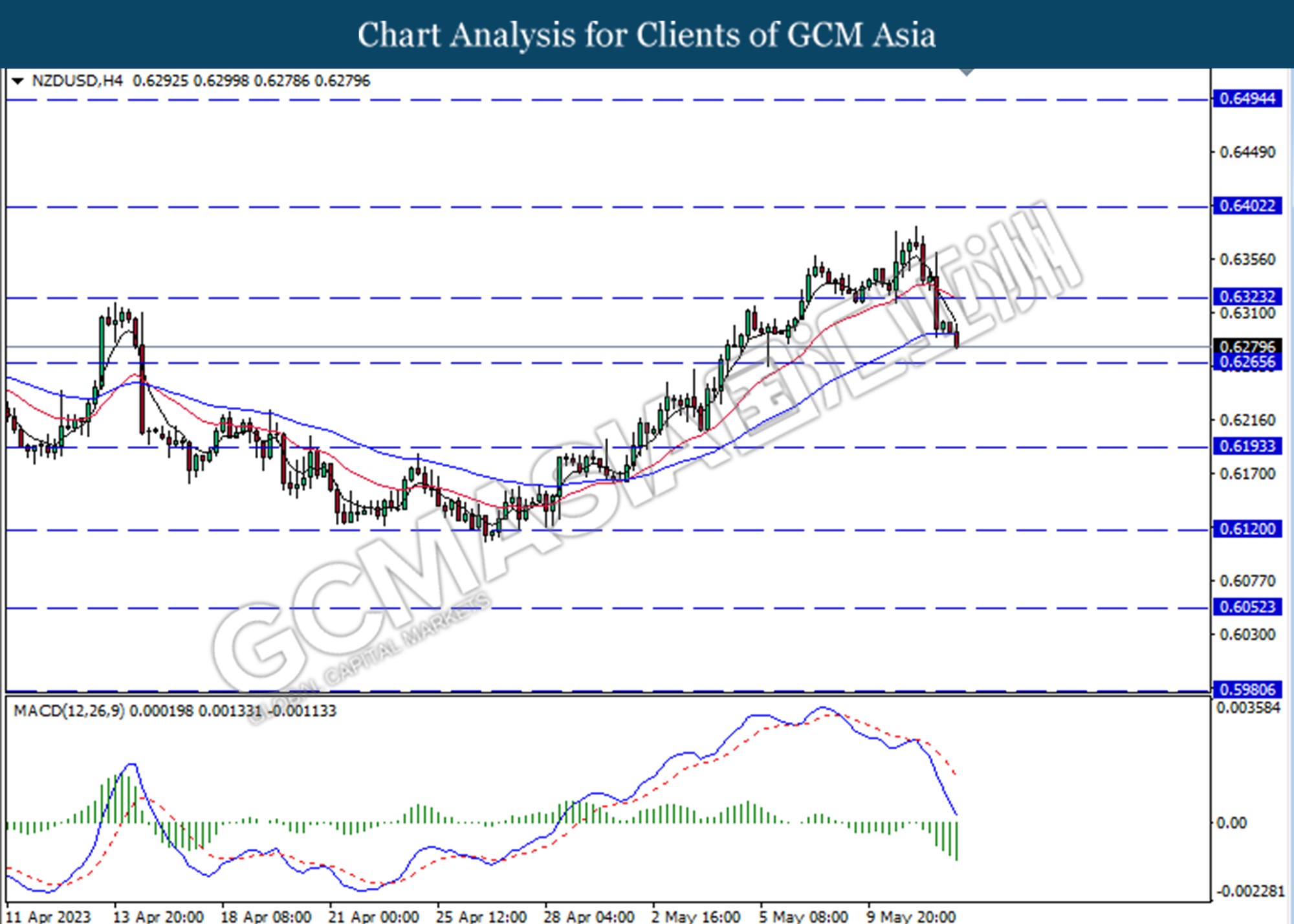

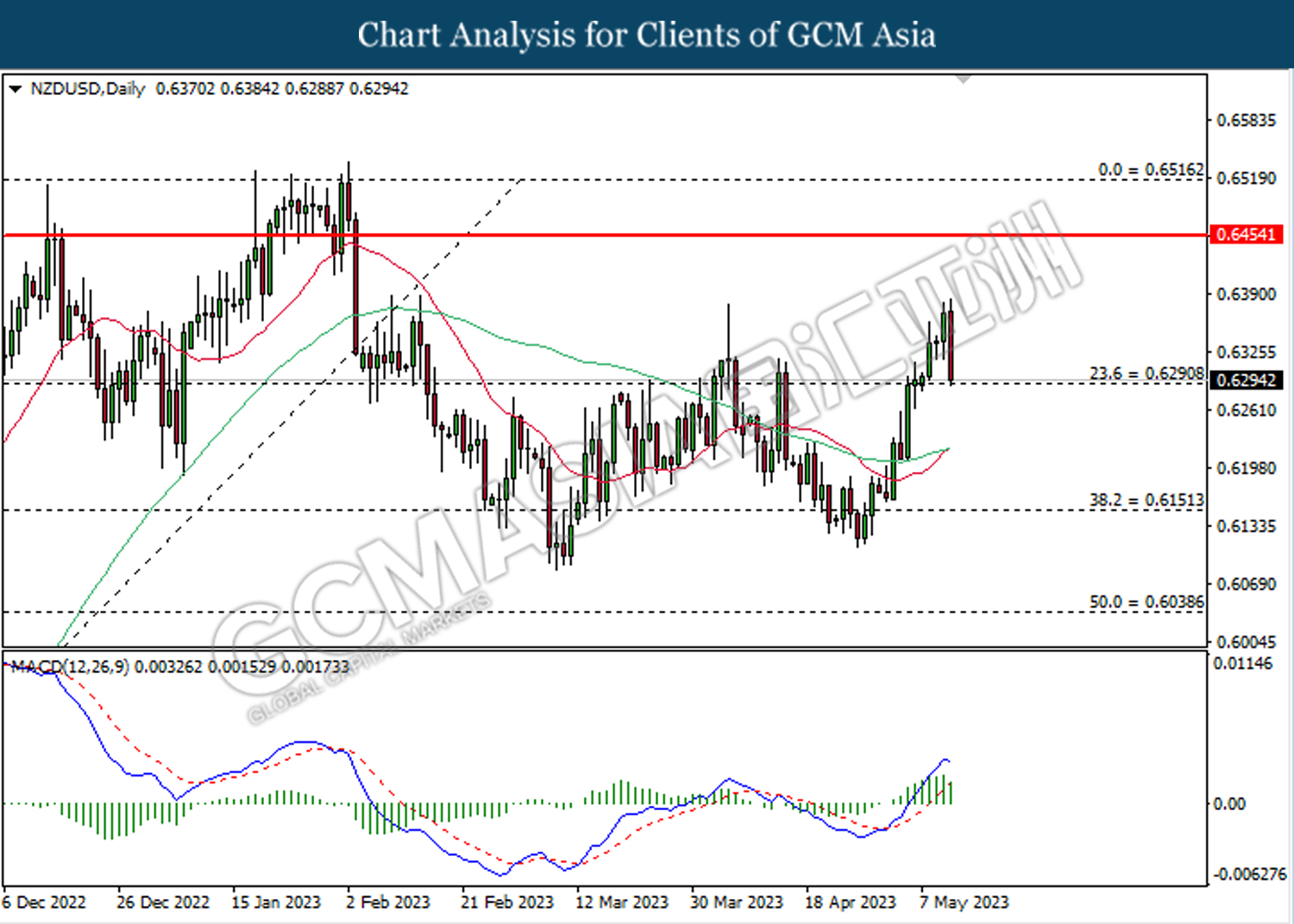

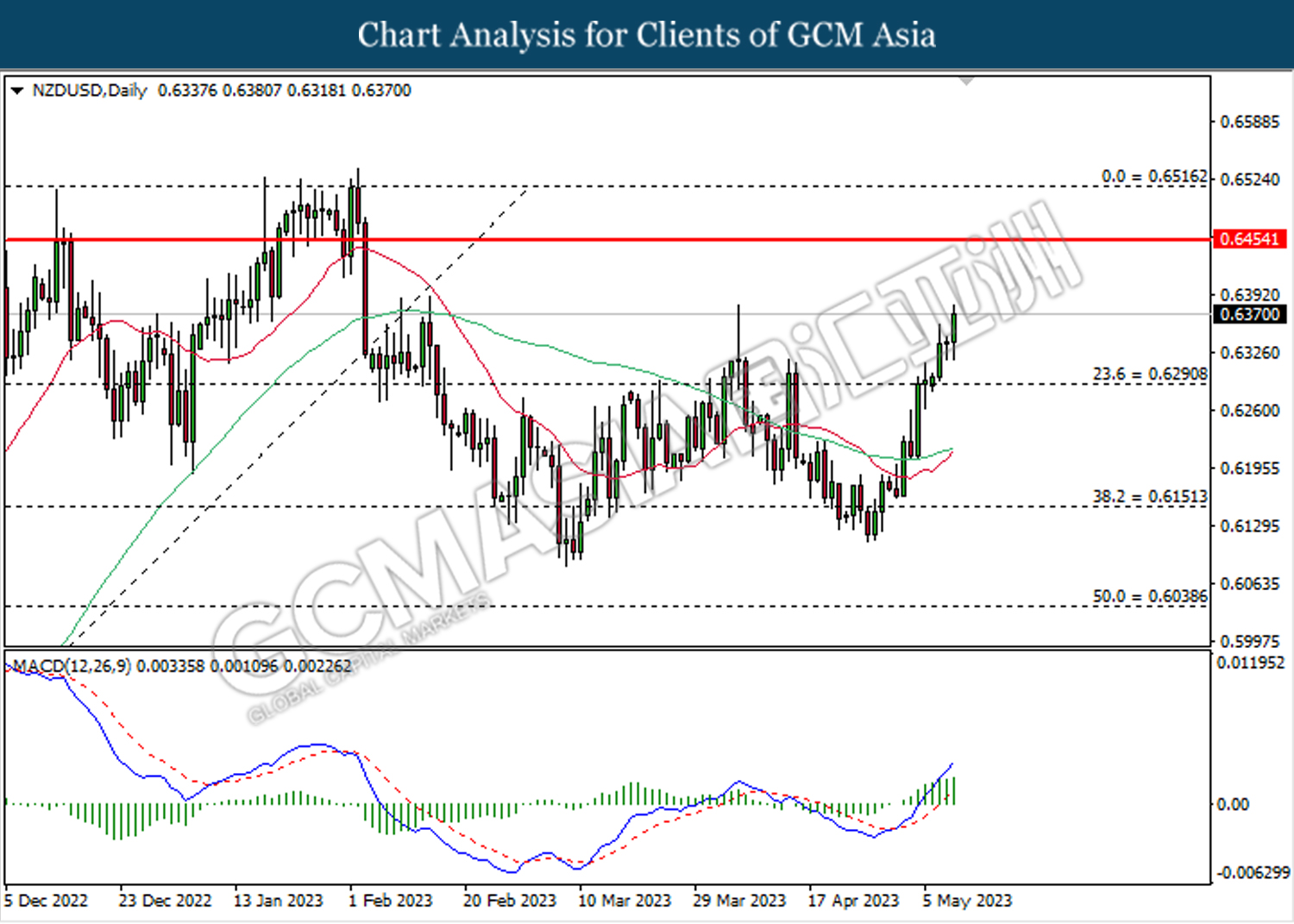

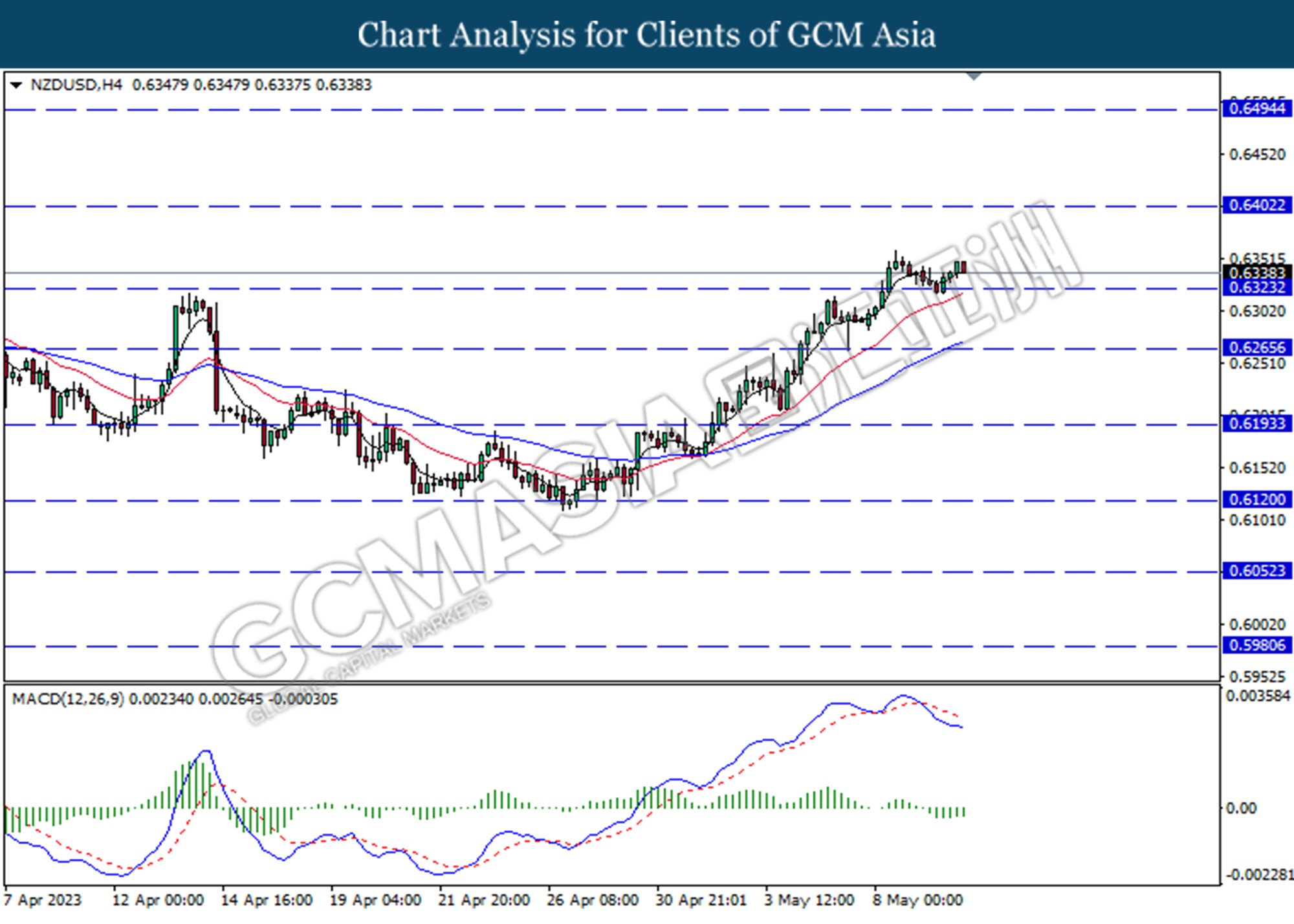

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

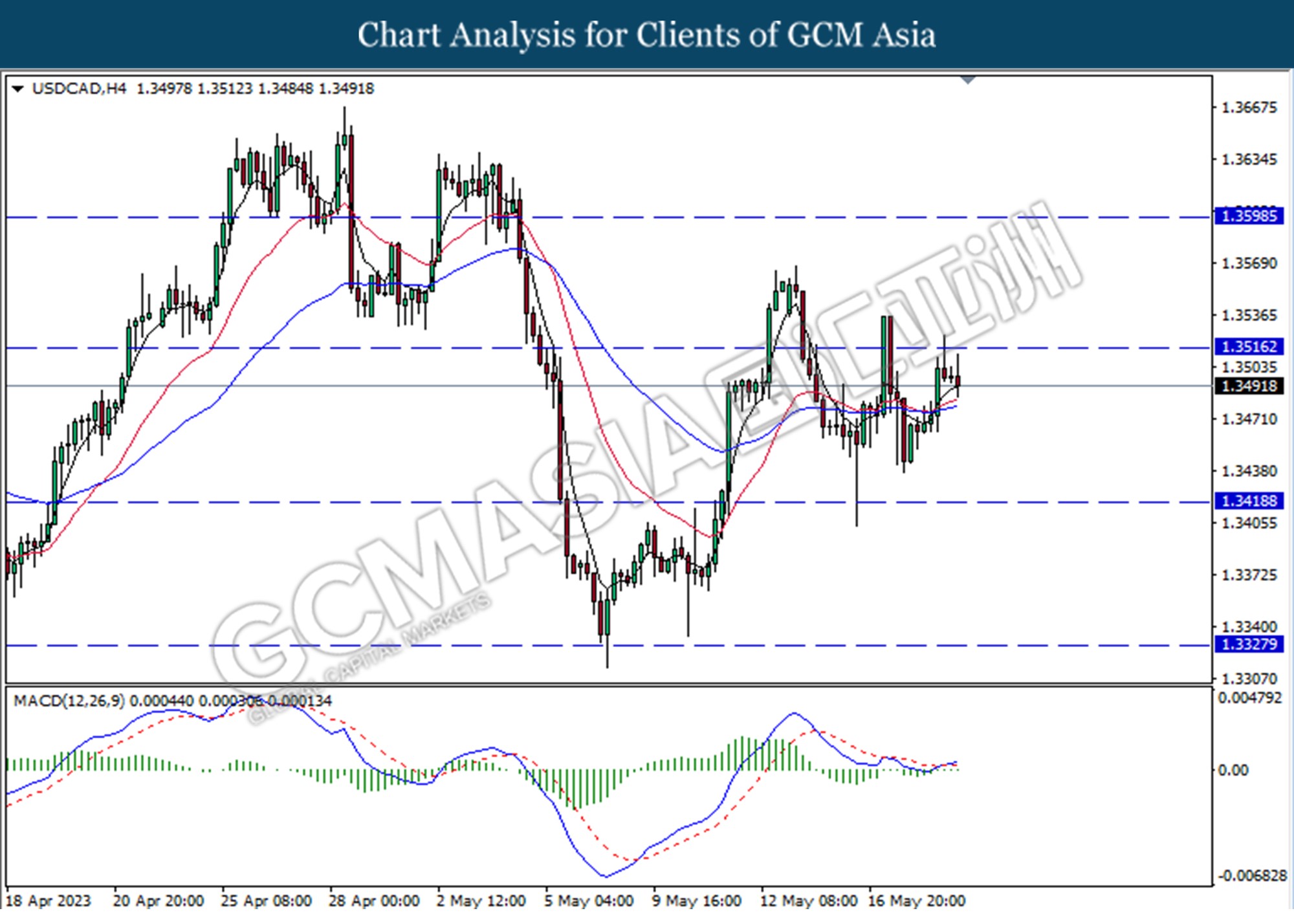

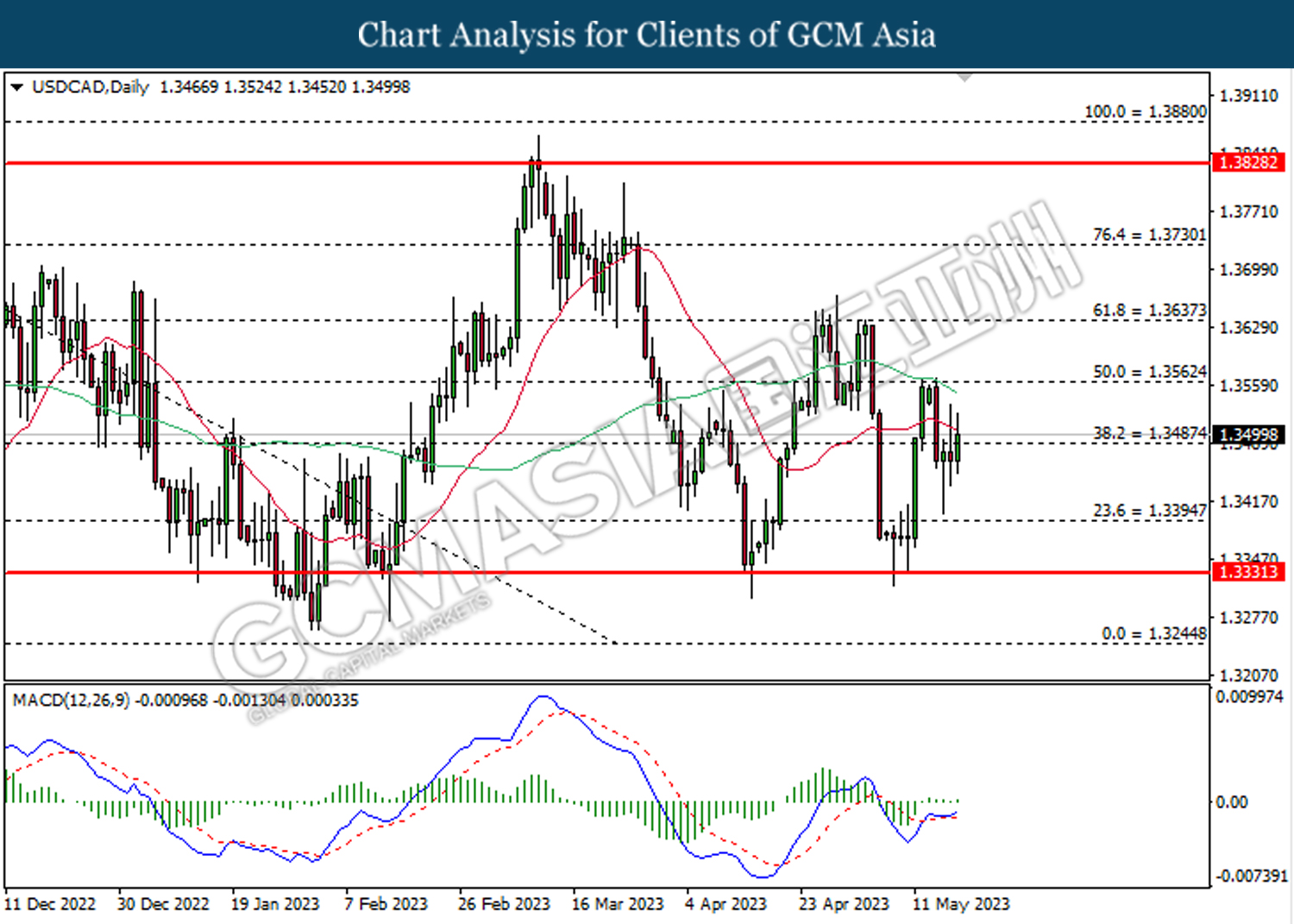

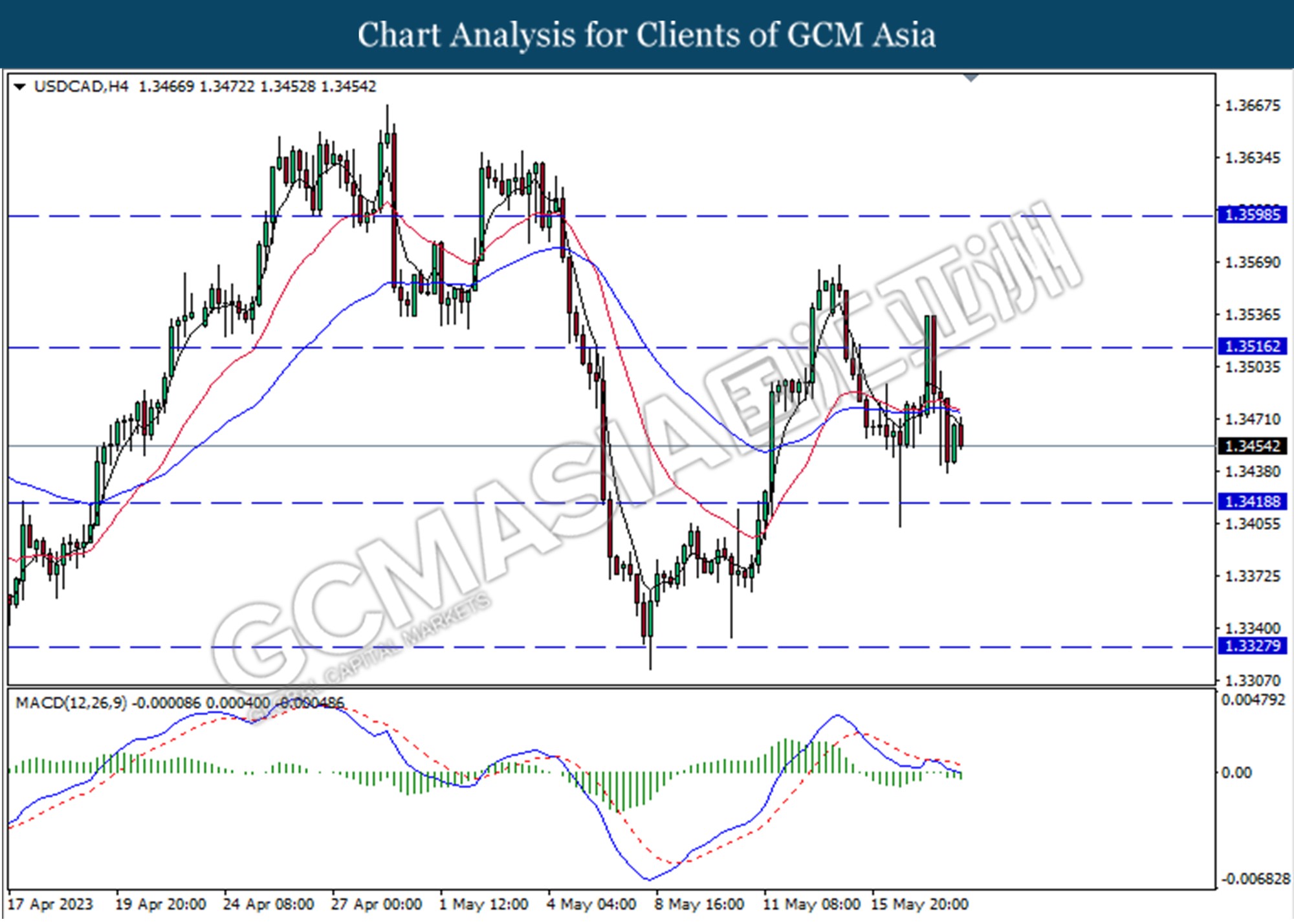

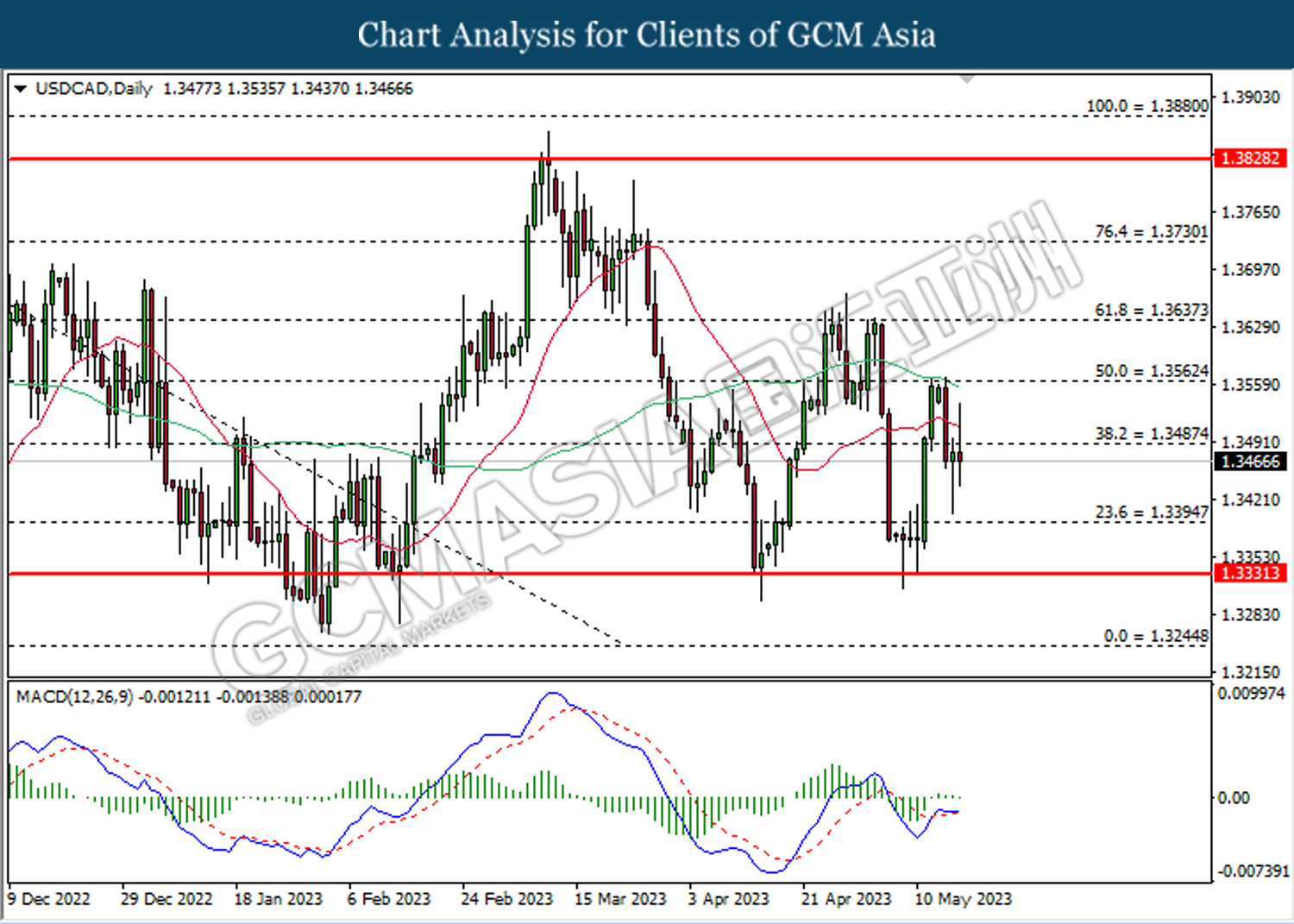

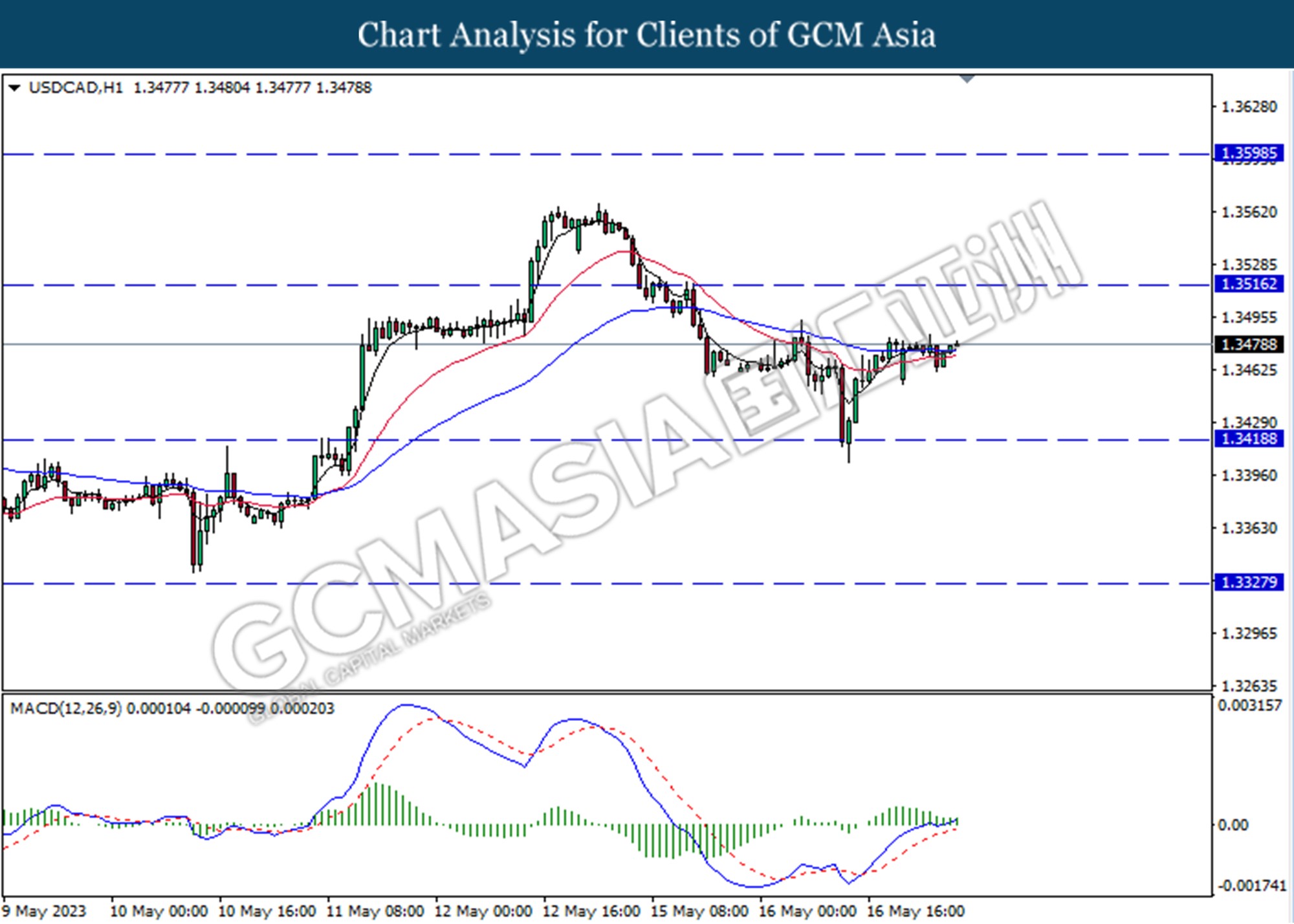

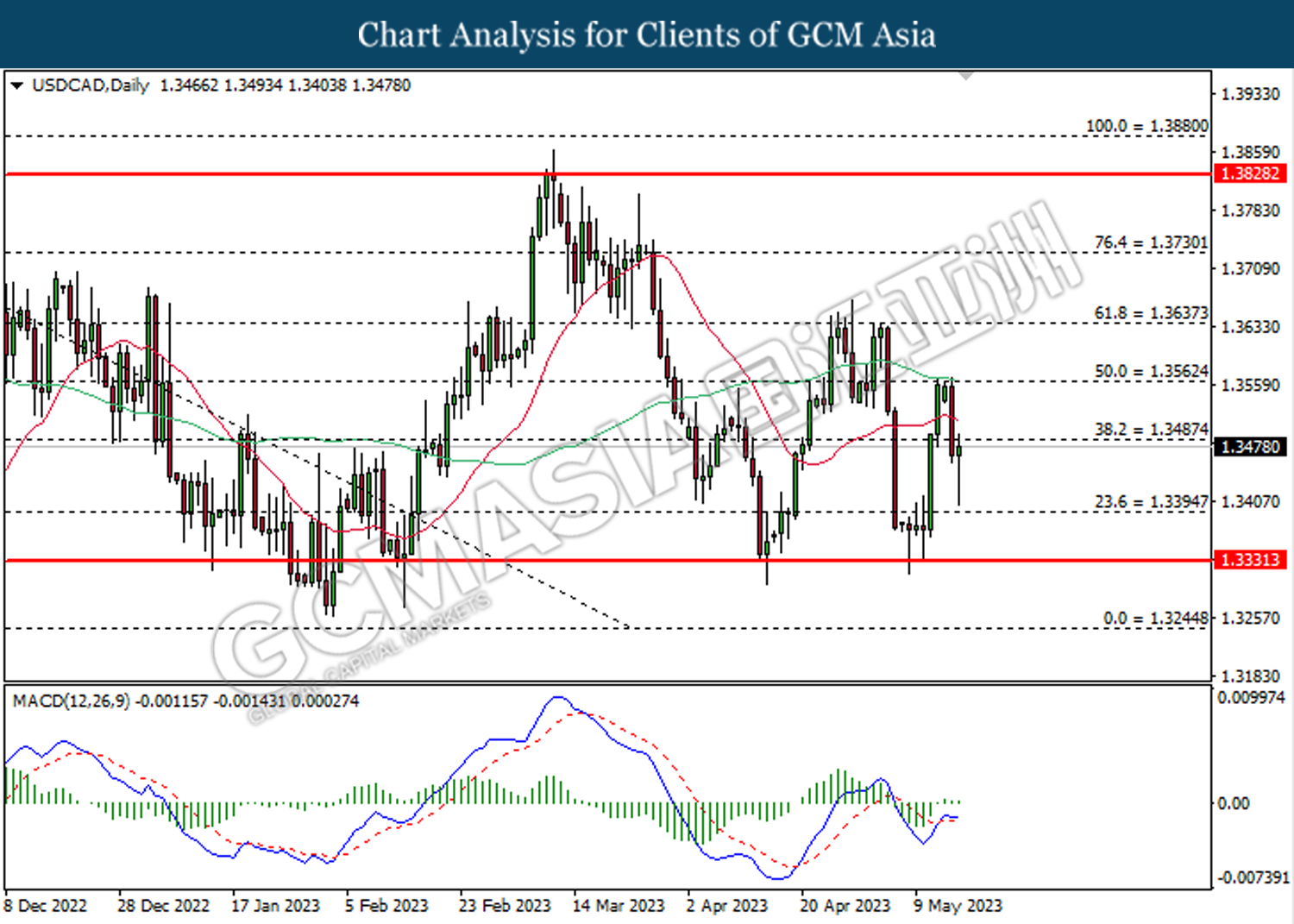

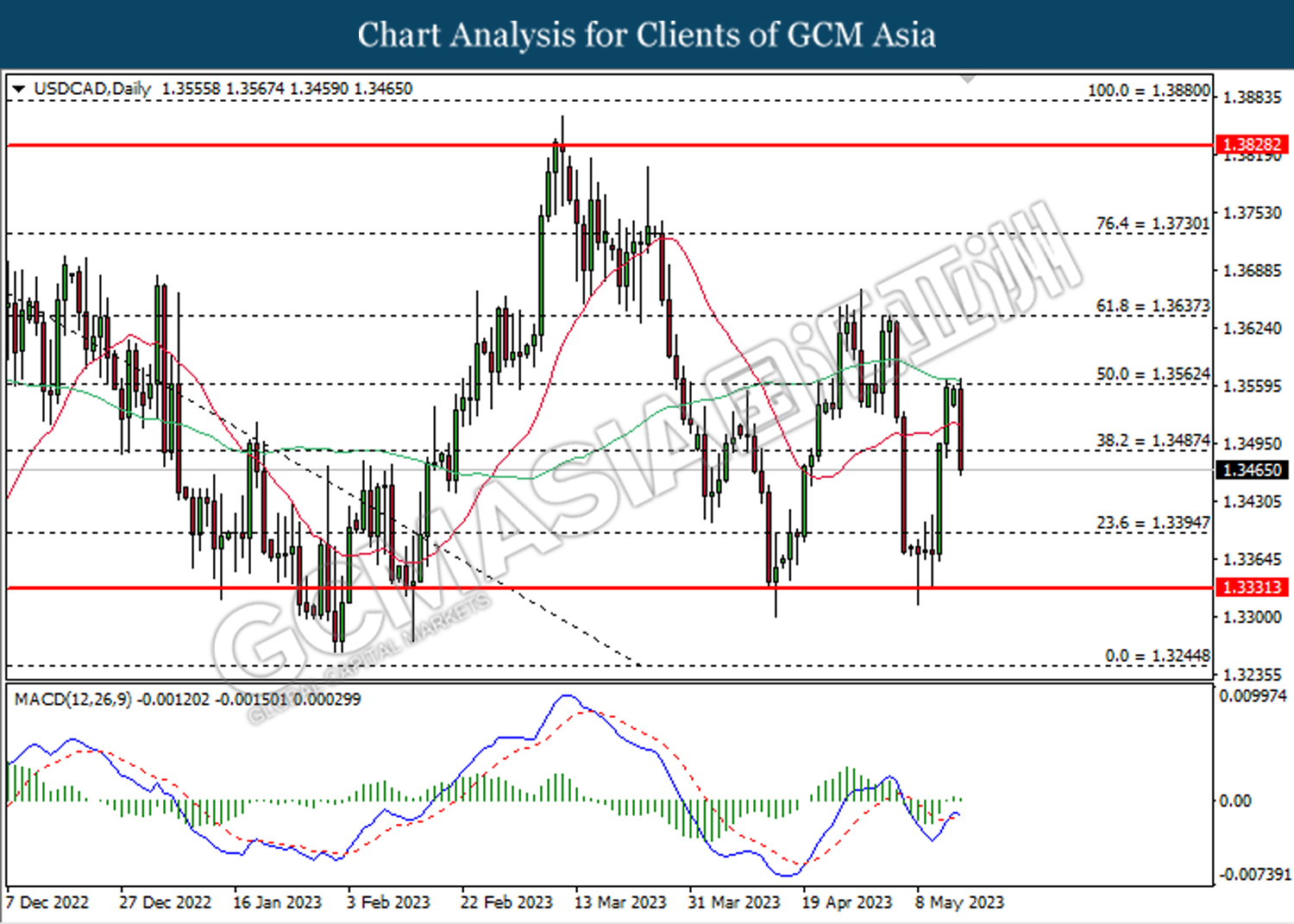

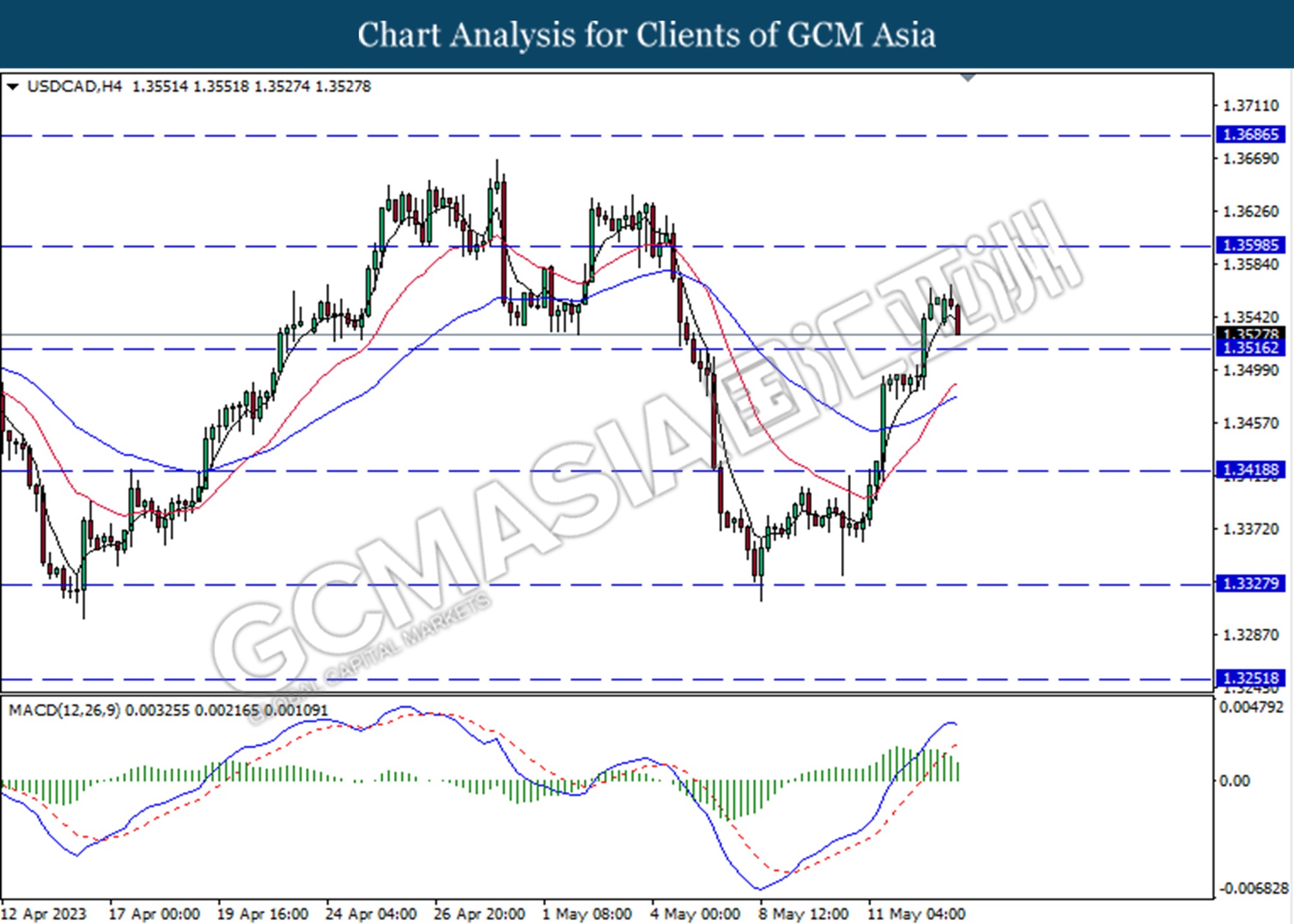

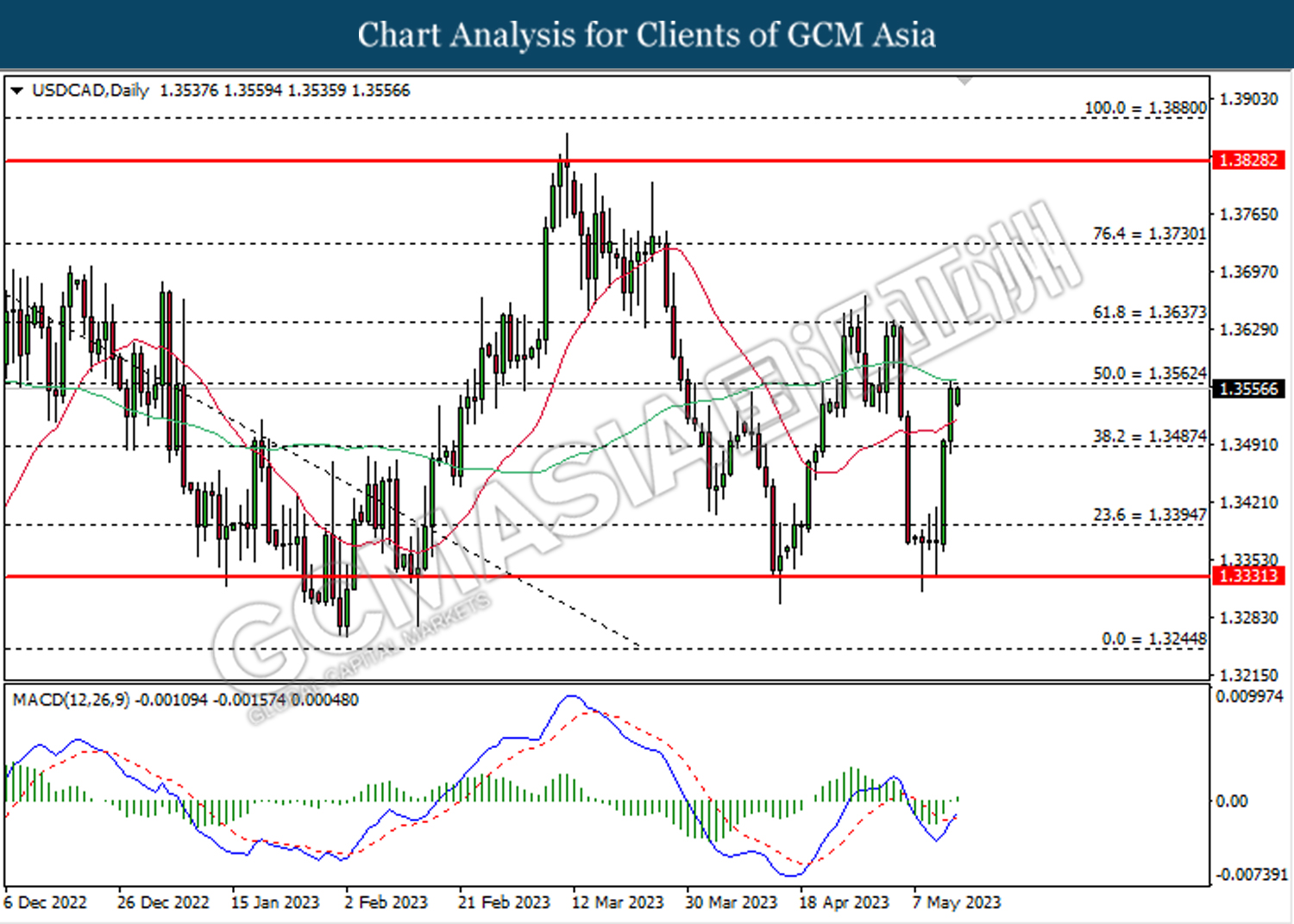

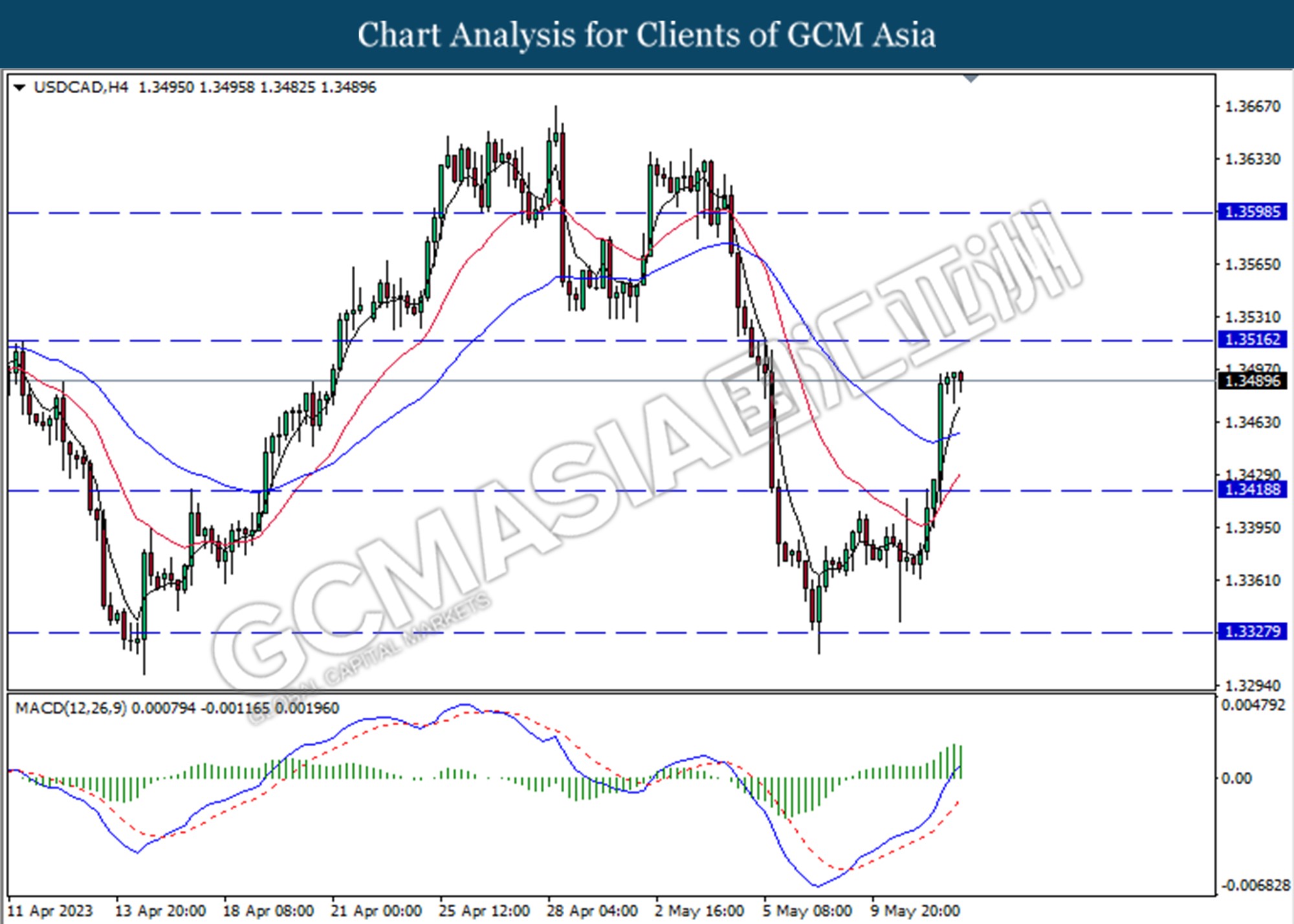

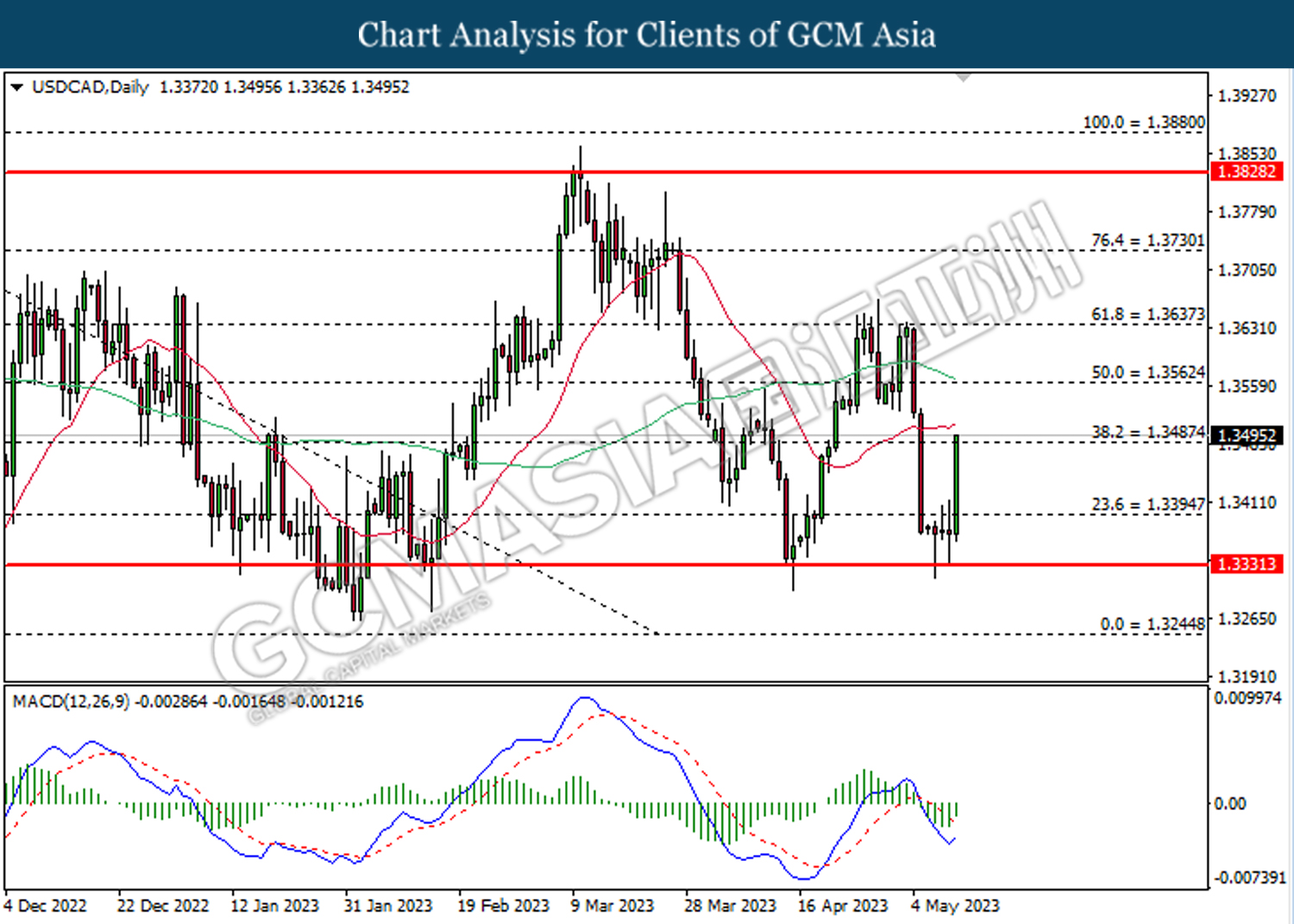

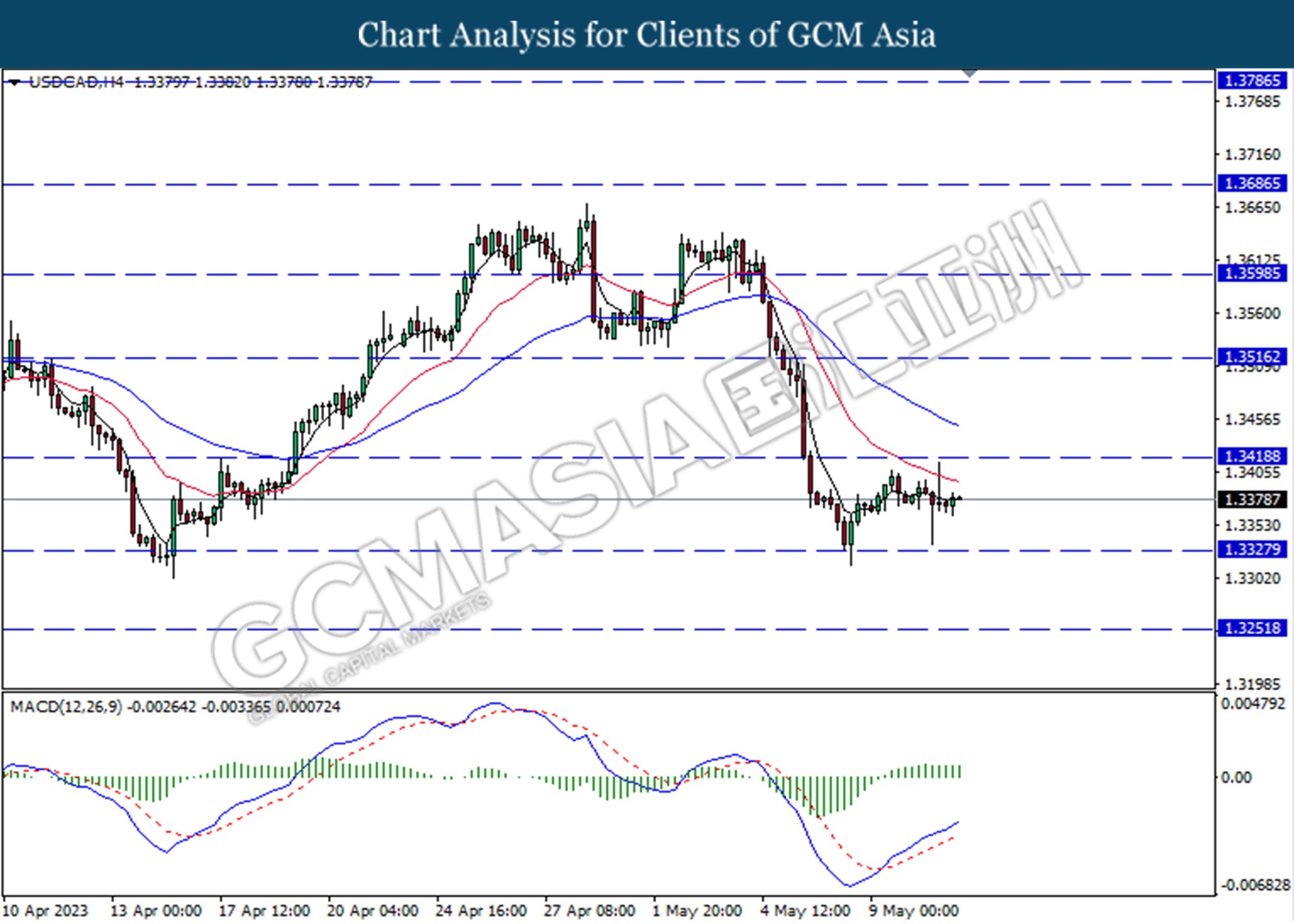

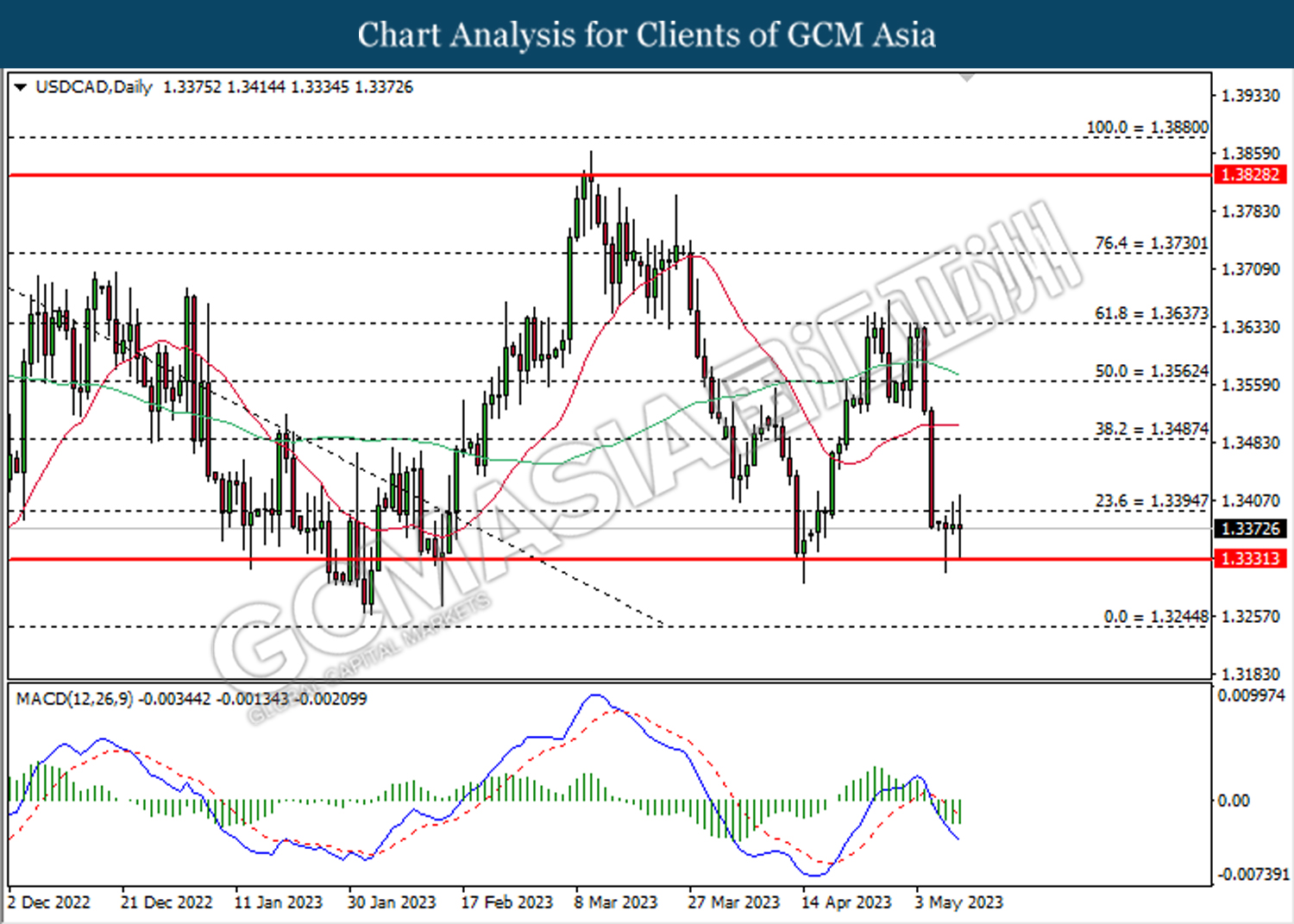

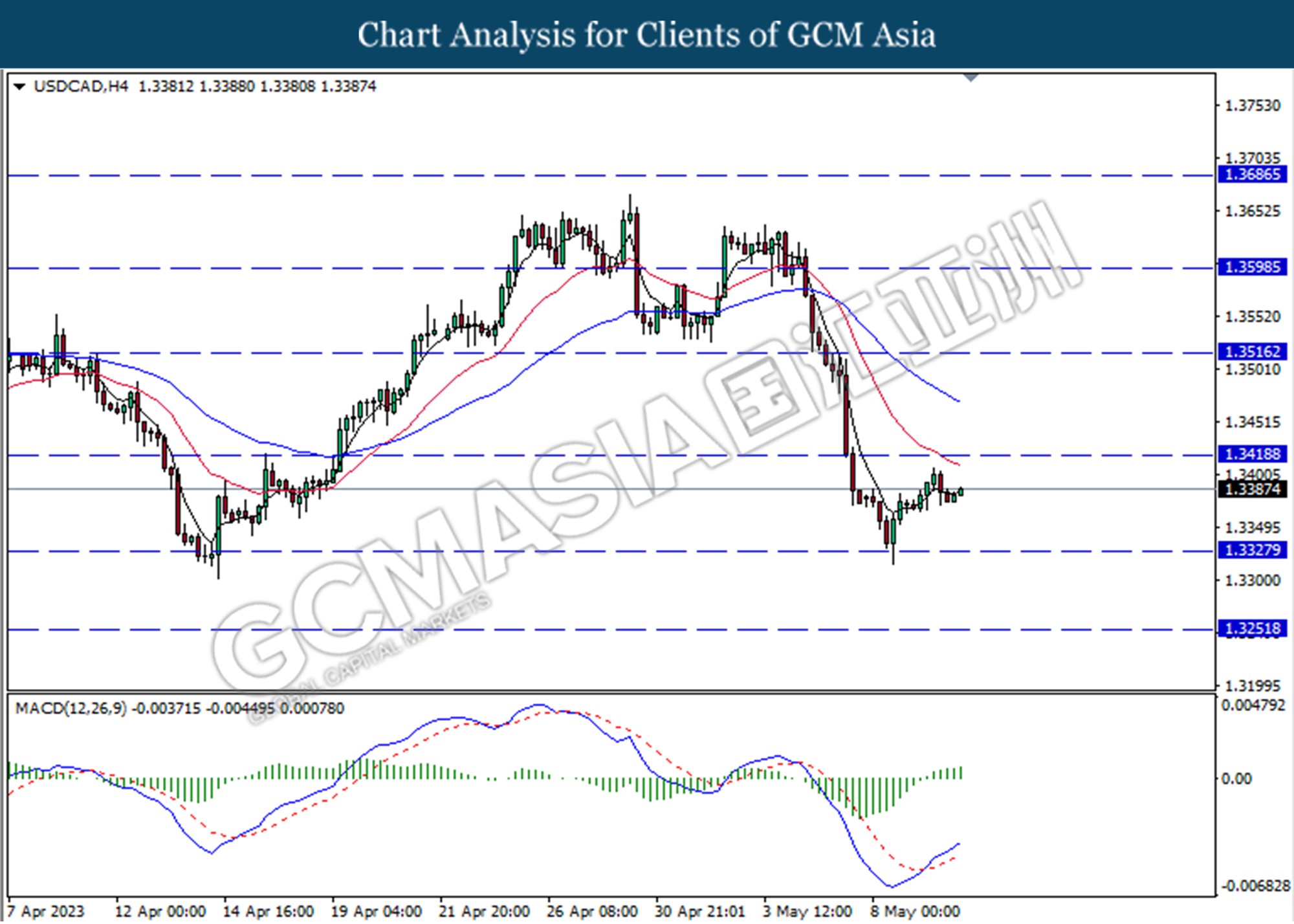

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3515. However, MACD which illustrated diminishing bearish momentum undergo technical correction in the short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

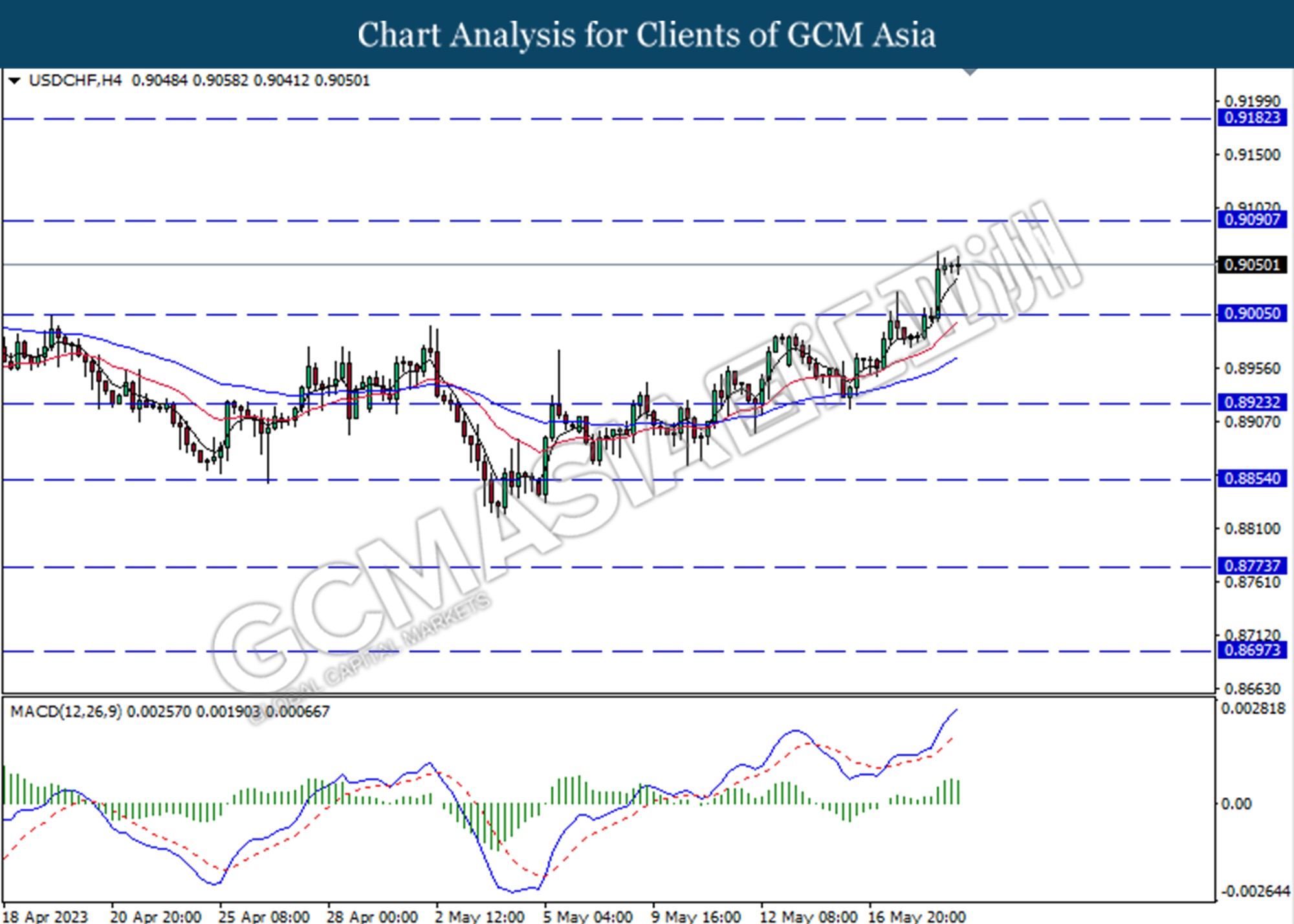

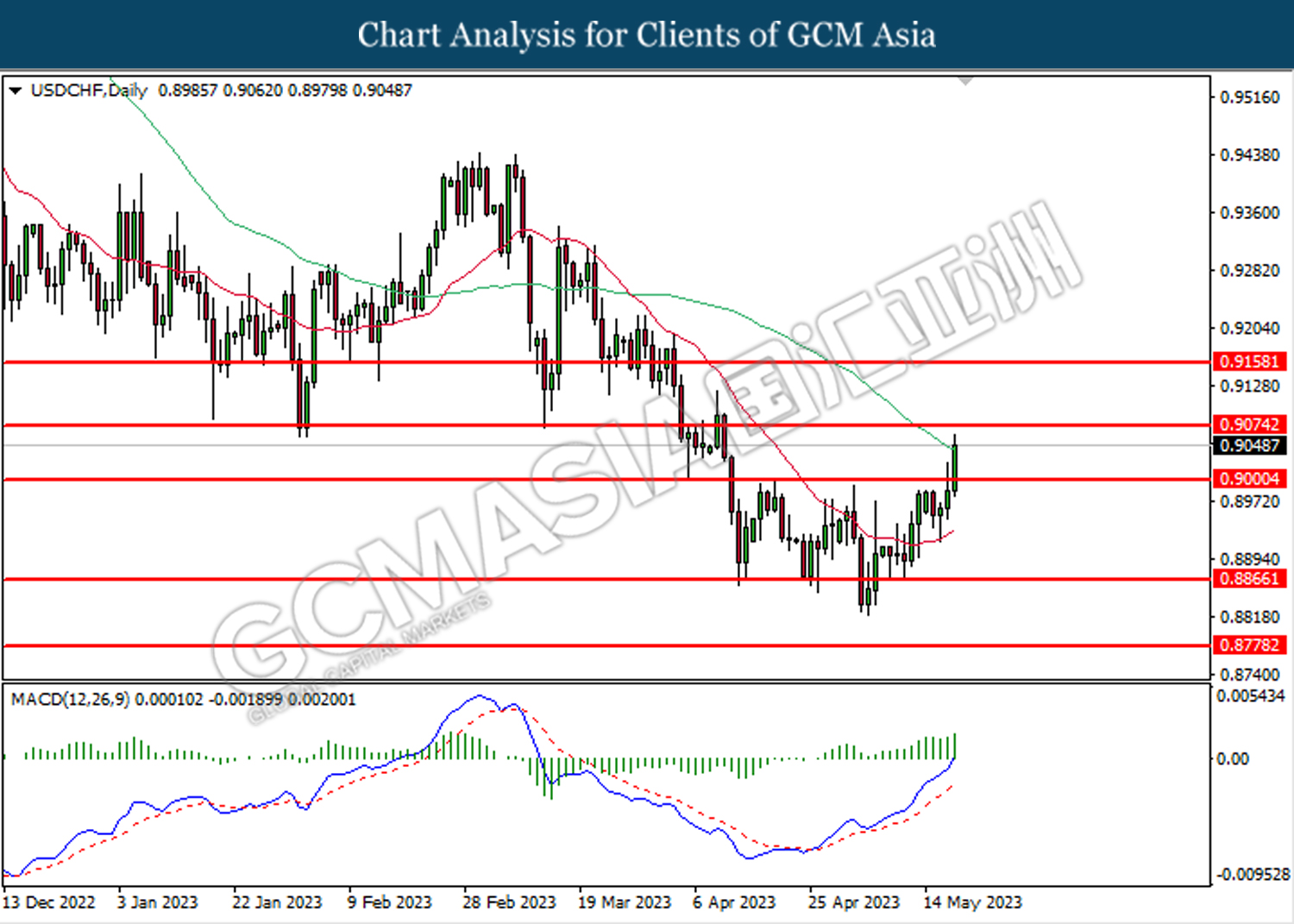

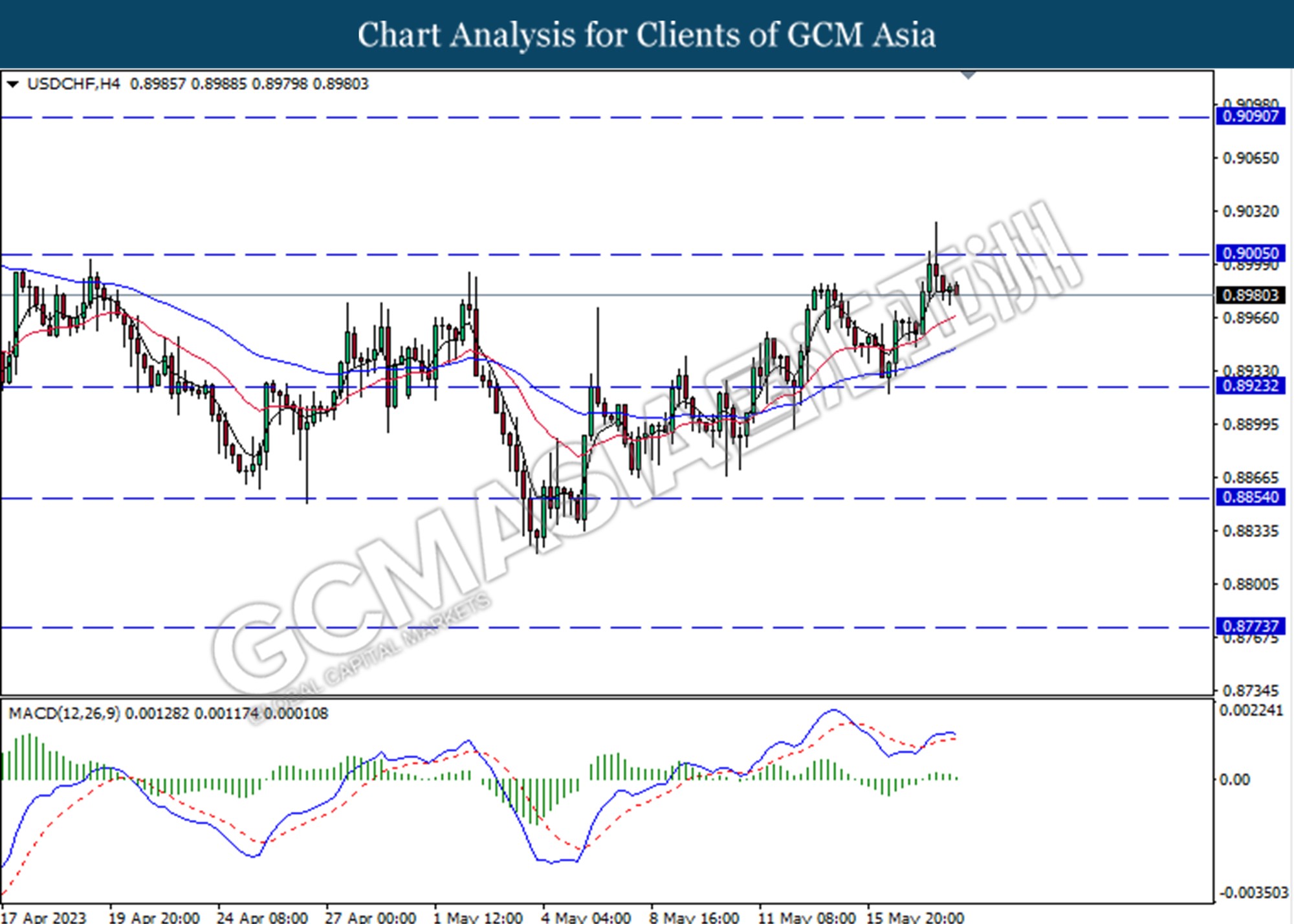

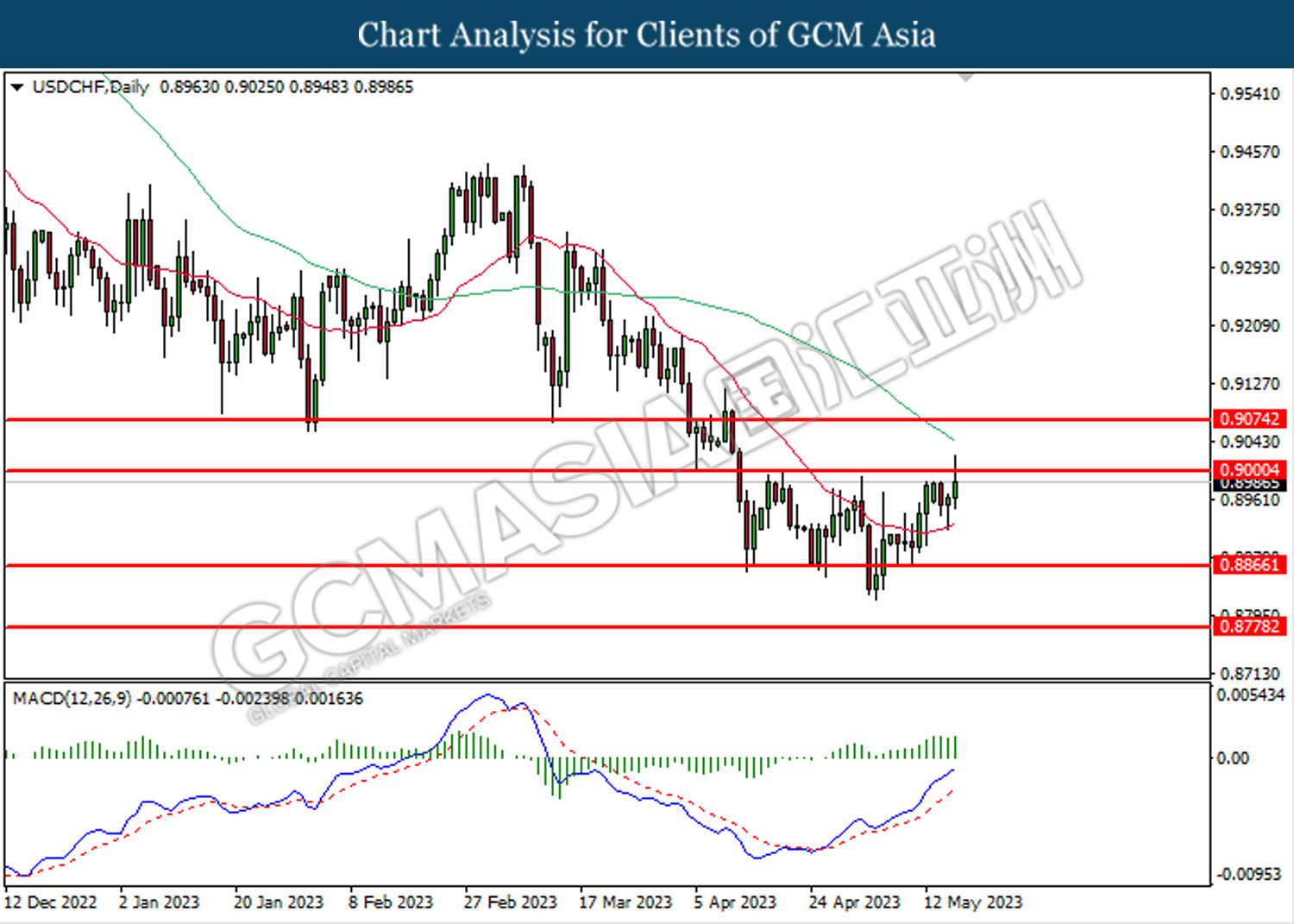

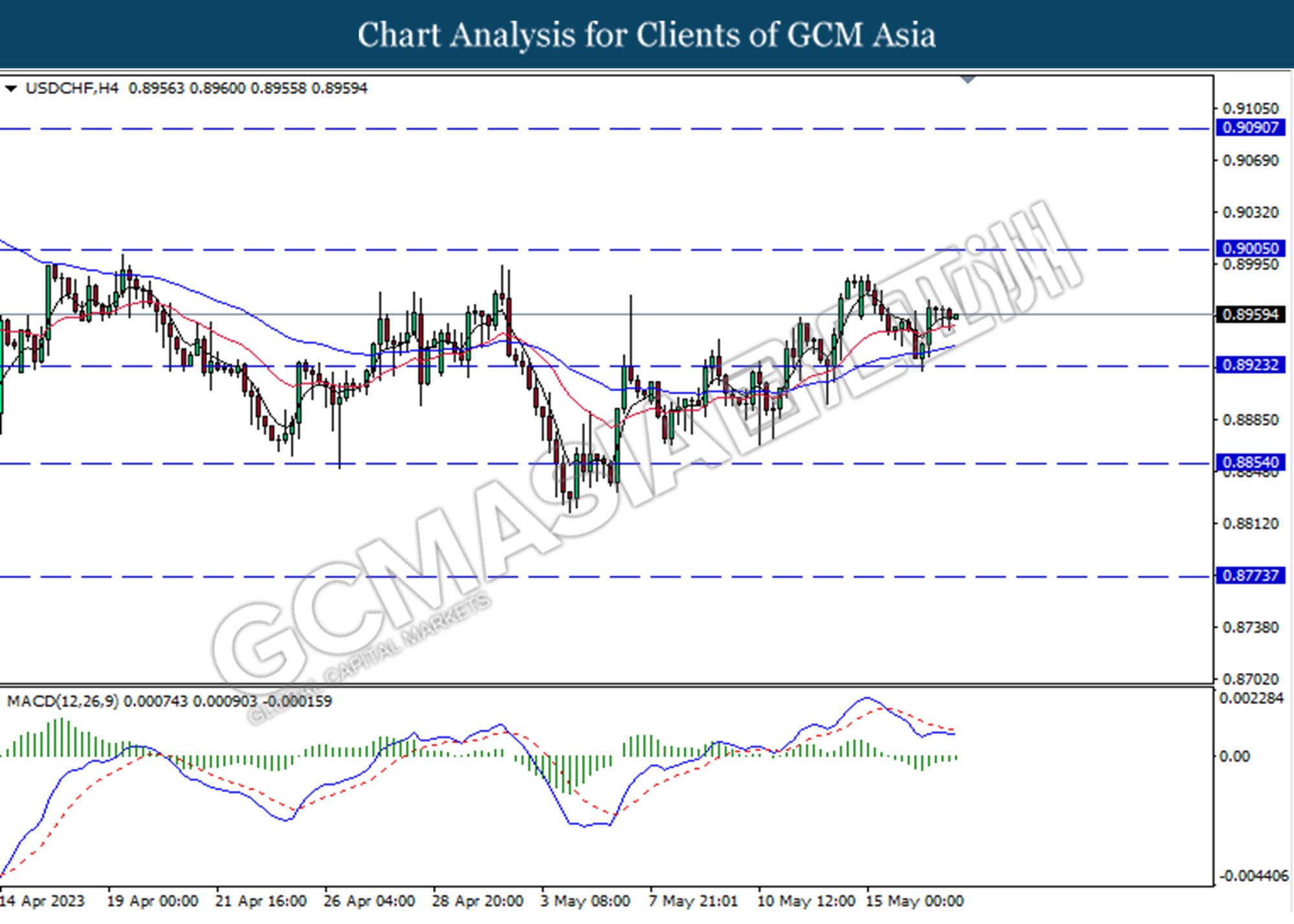

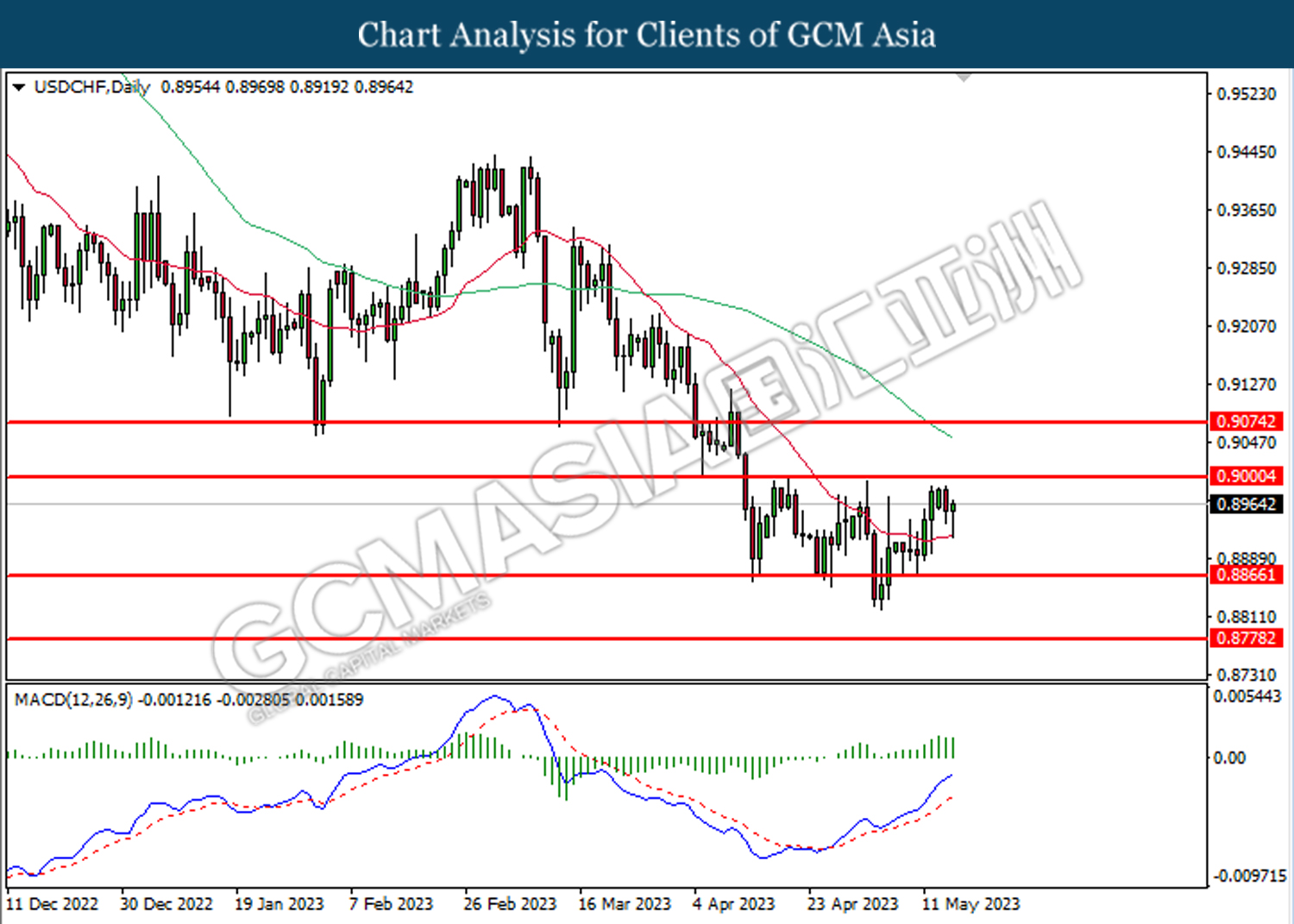

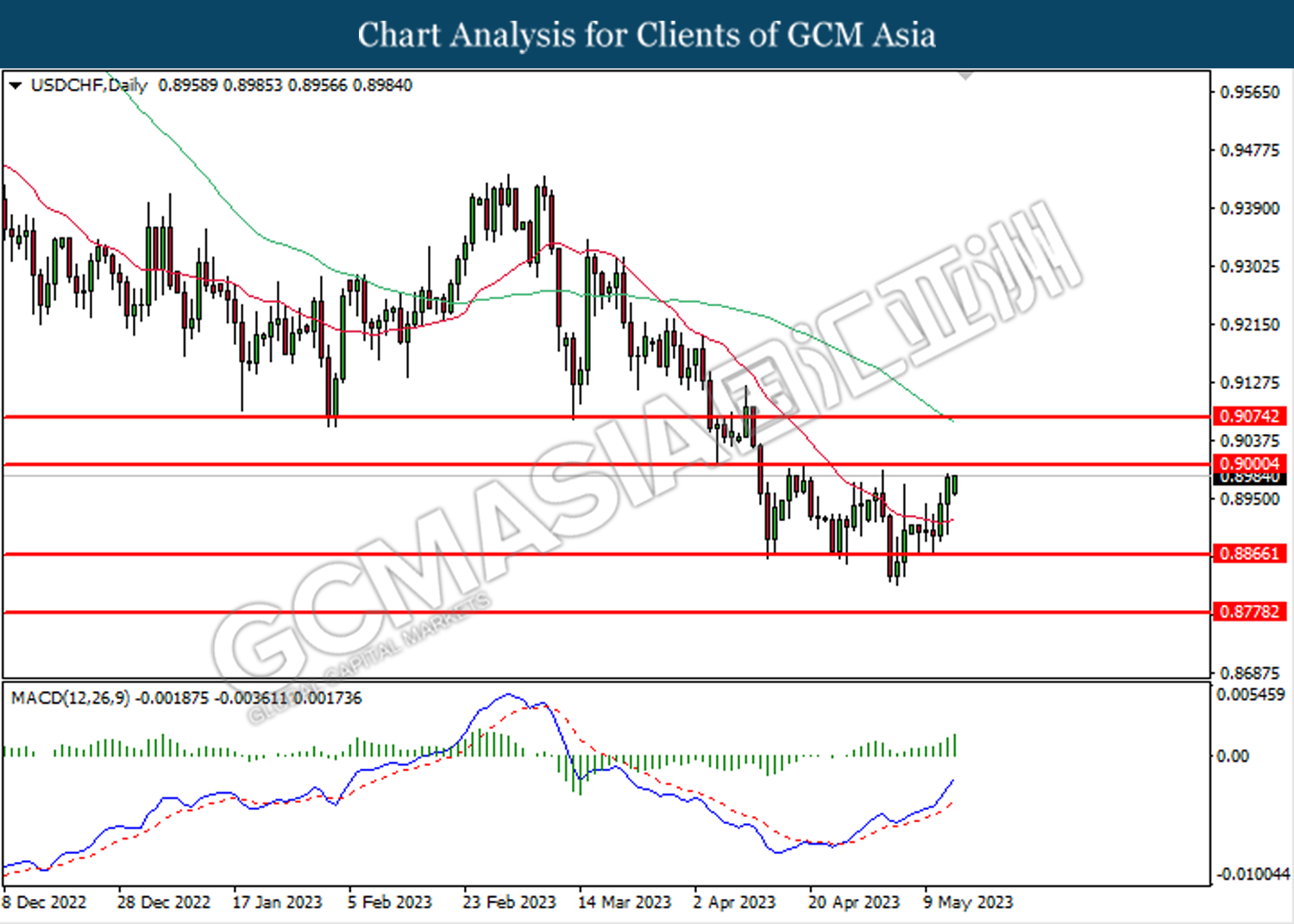

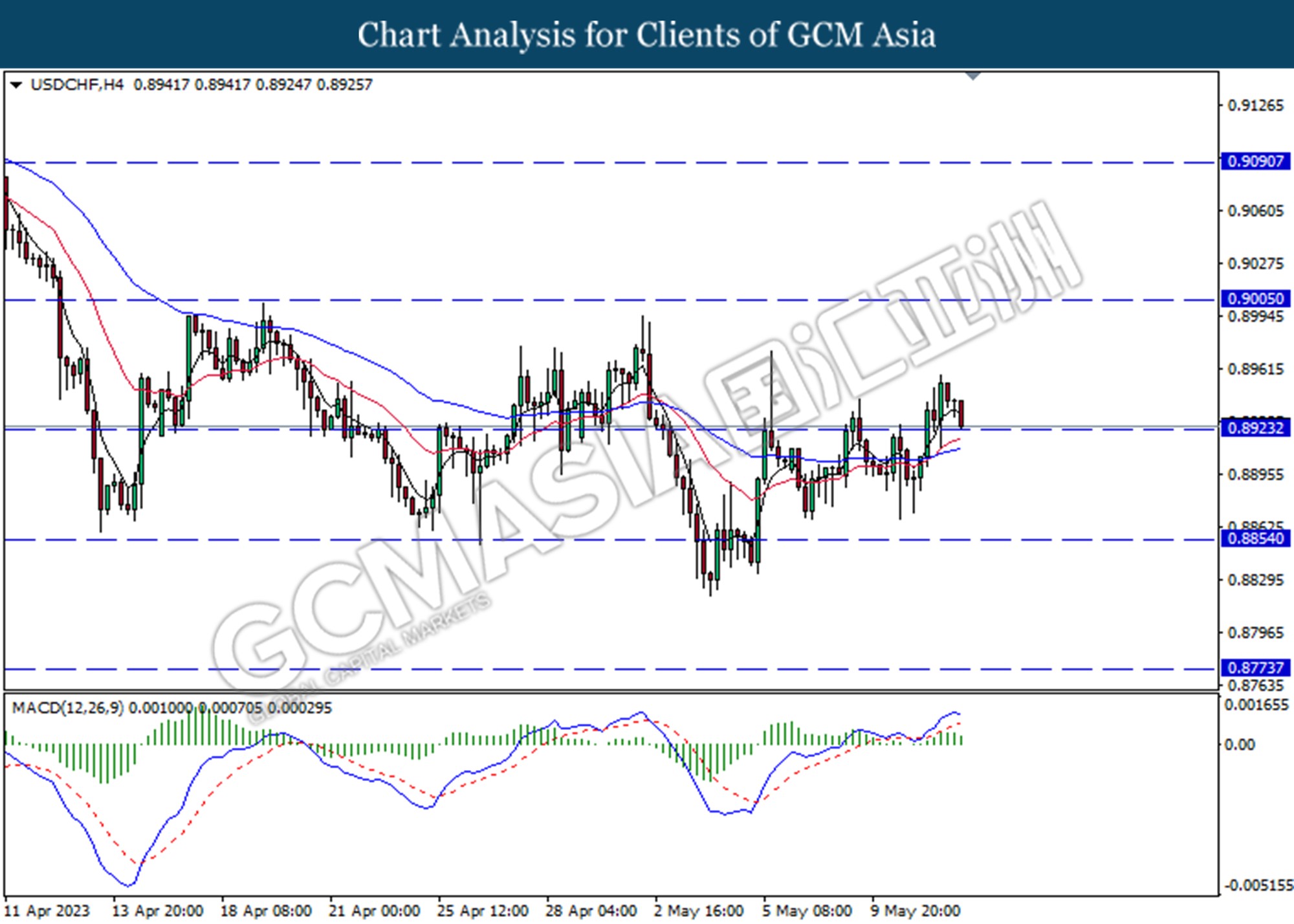

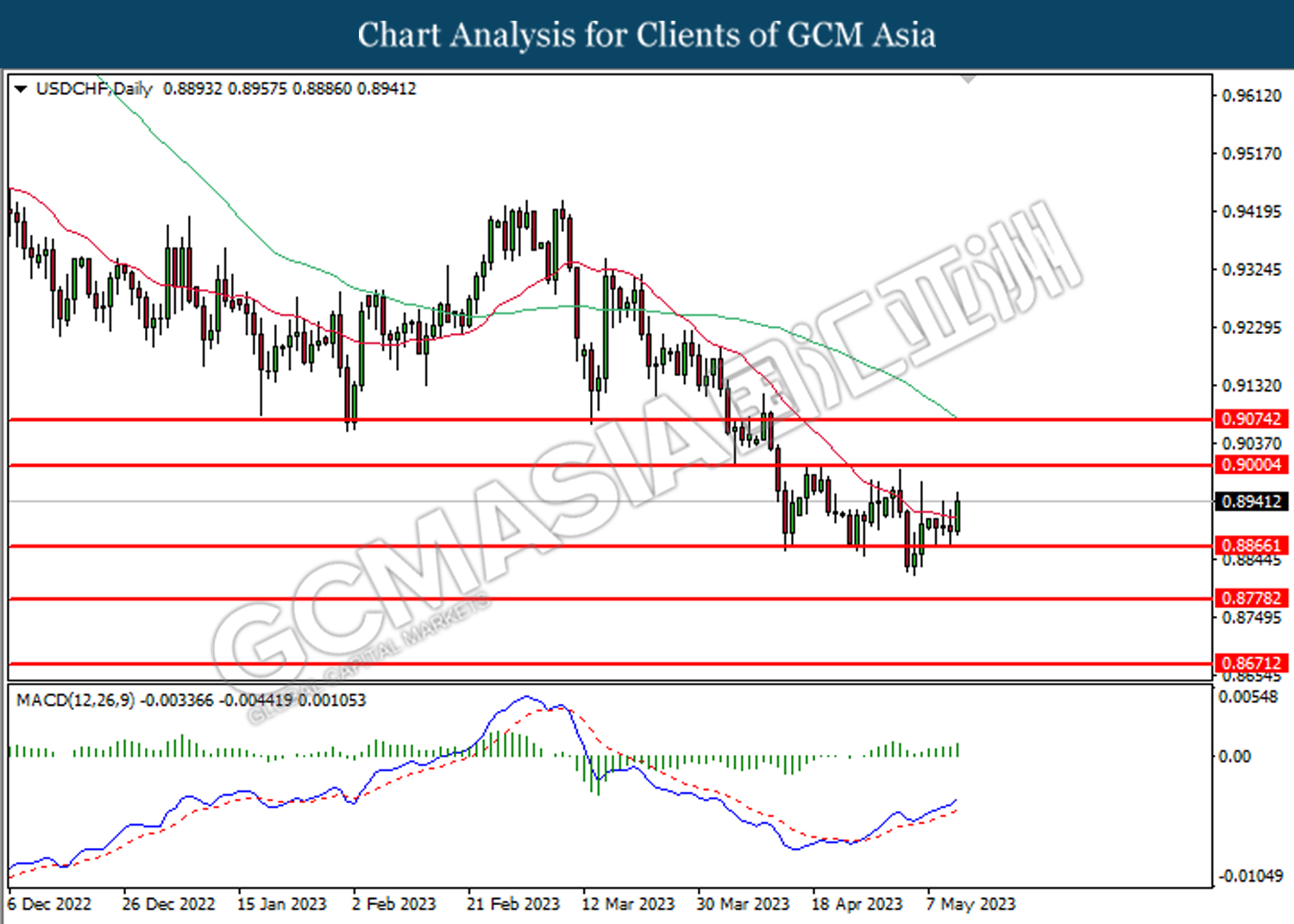

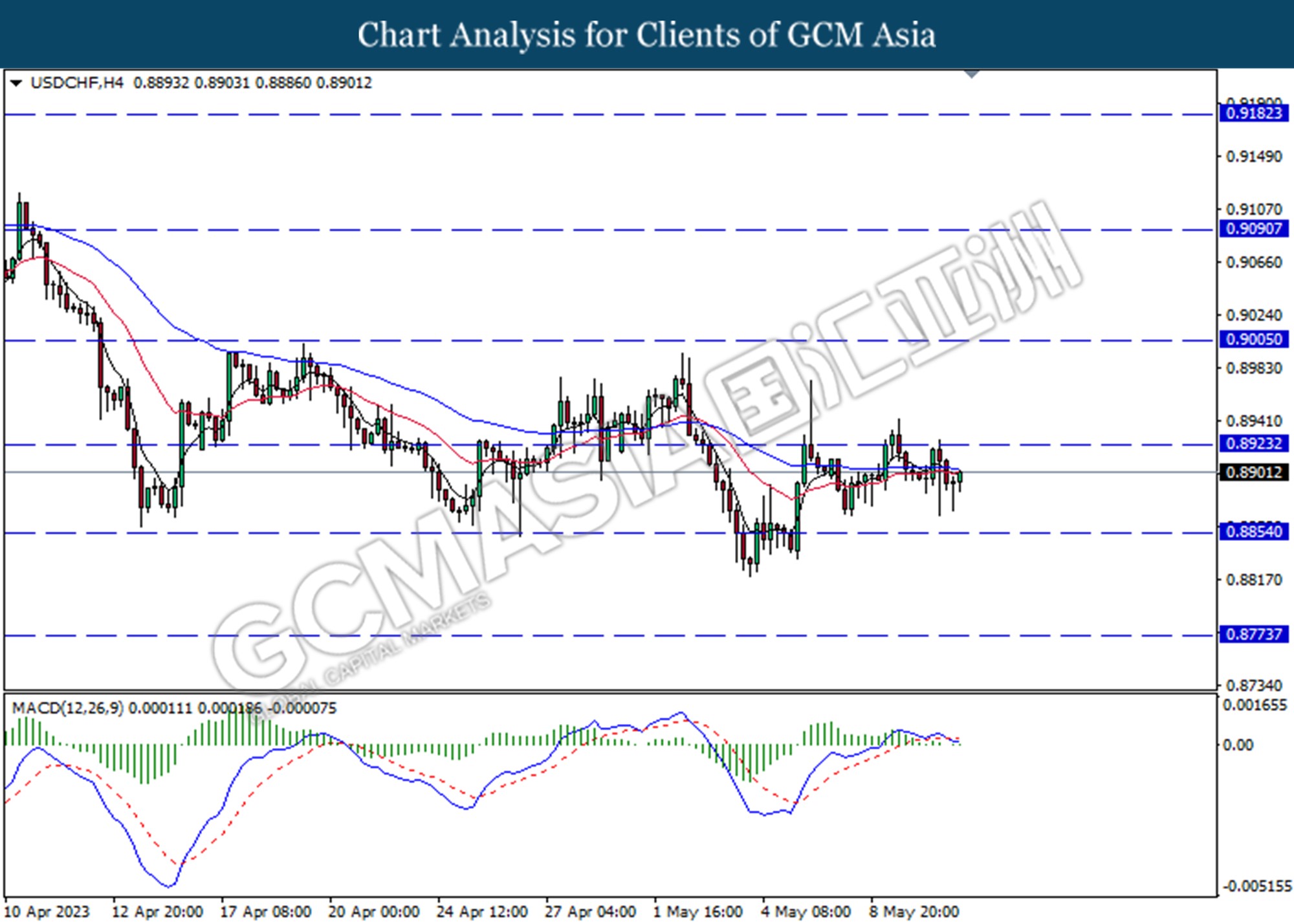

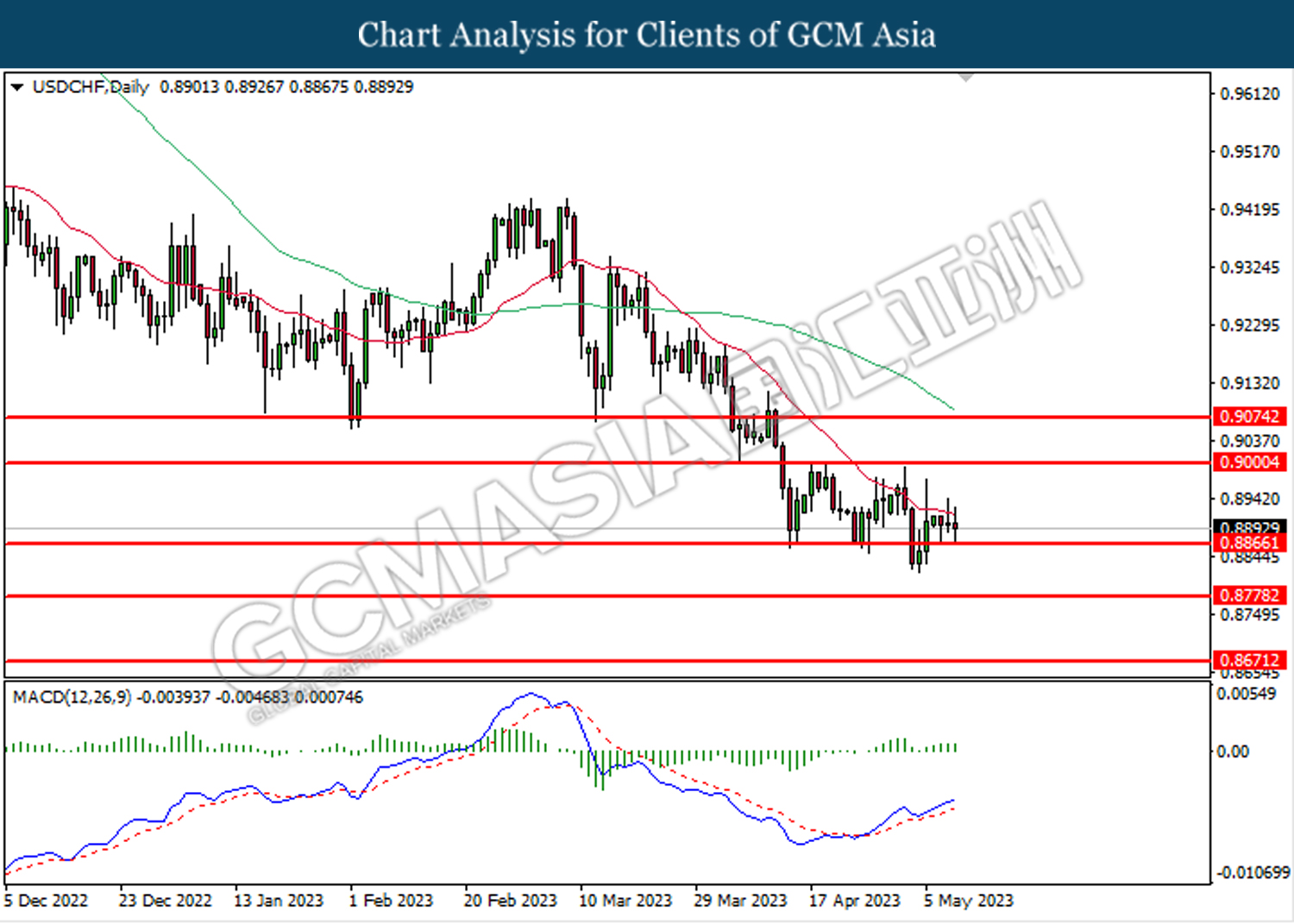

USDCHF, H4: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.9005. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

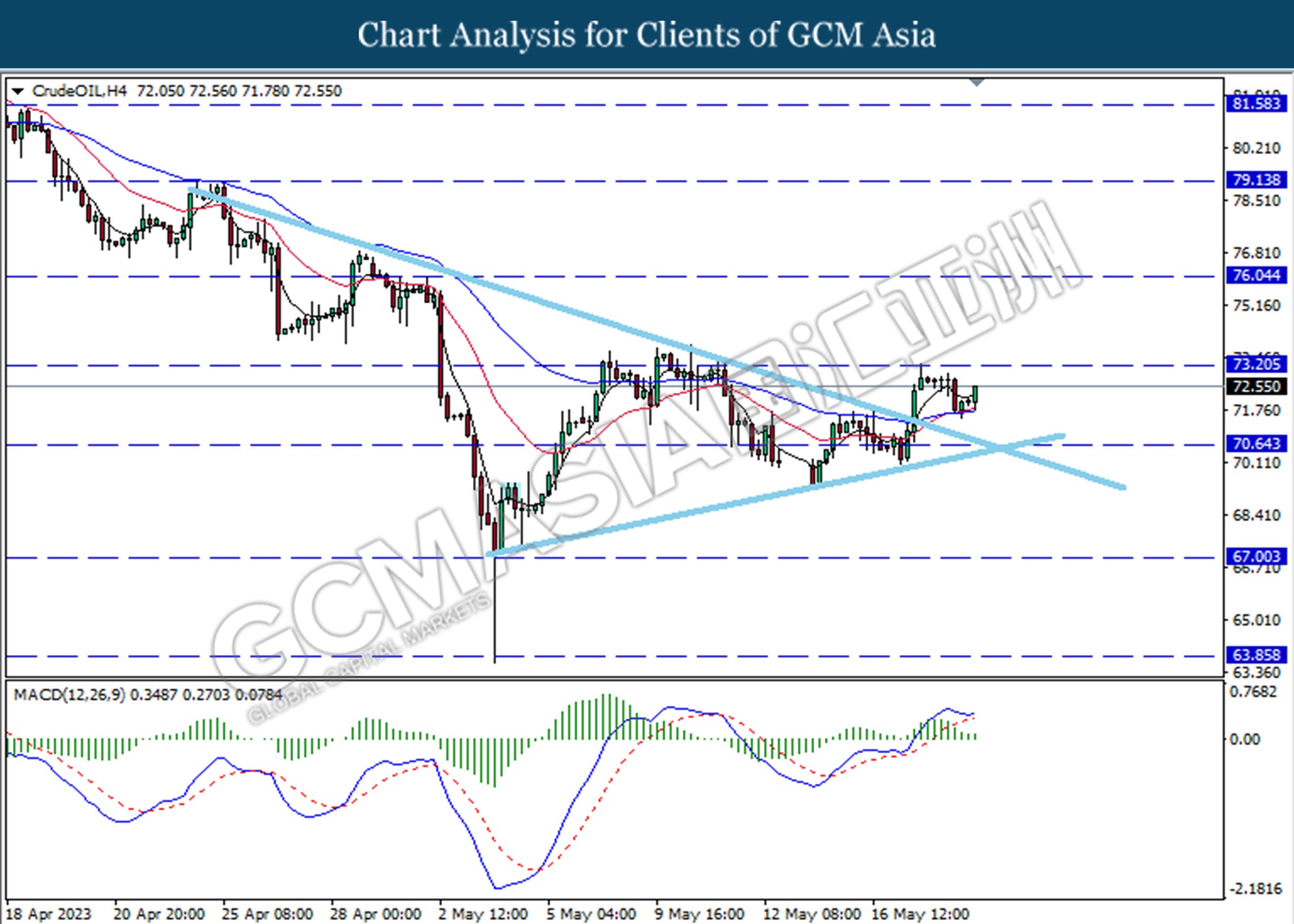

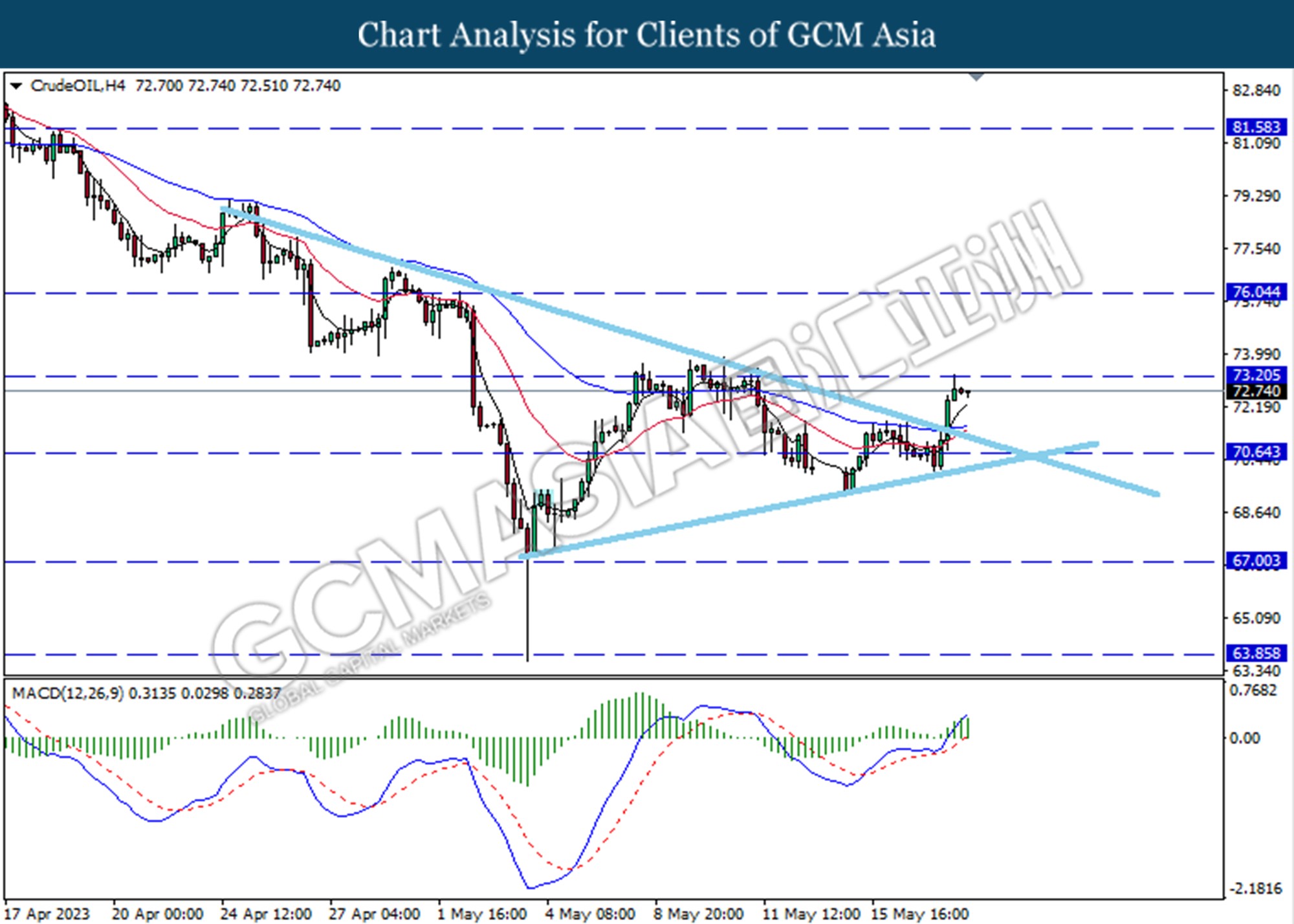

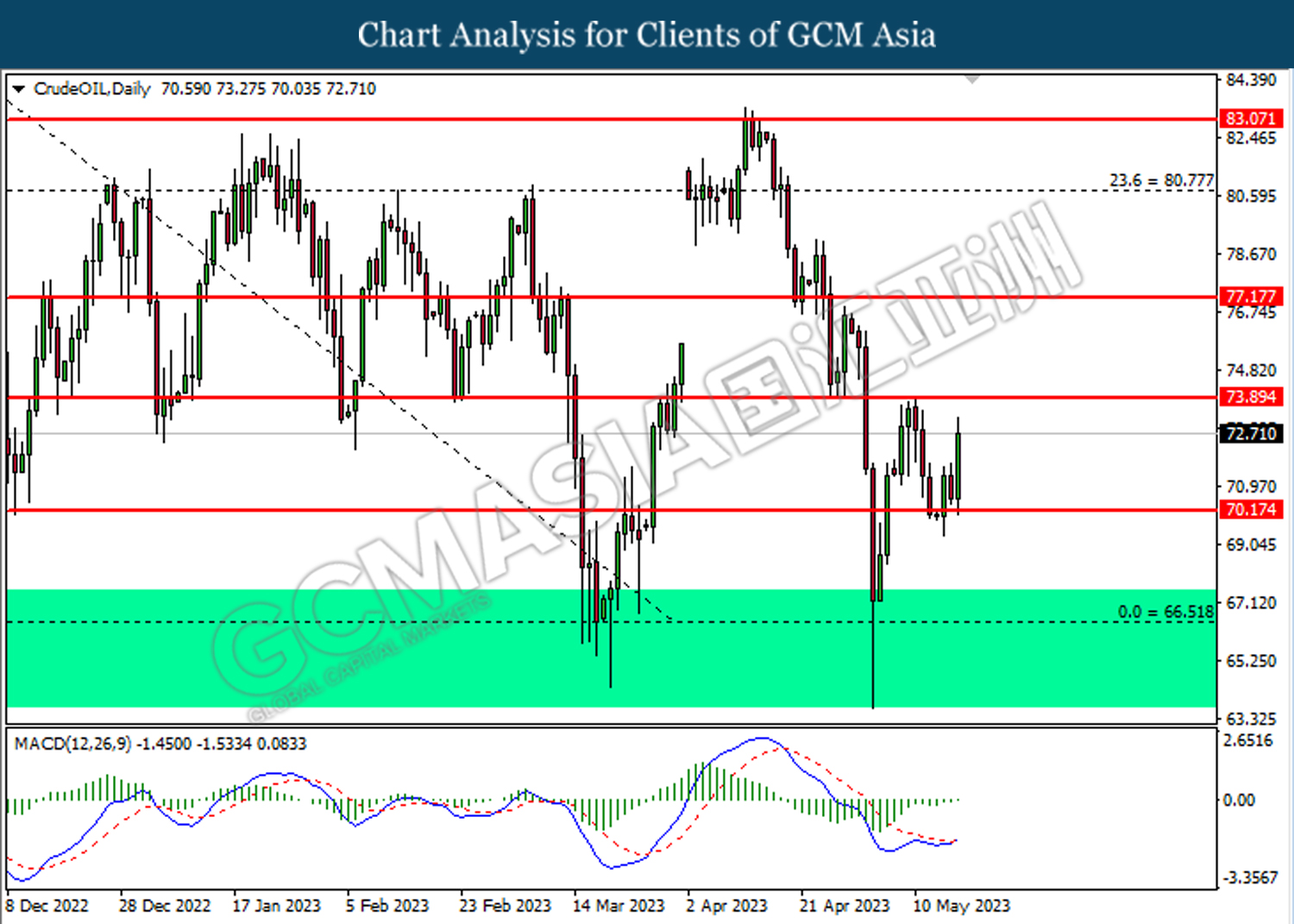

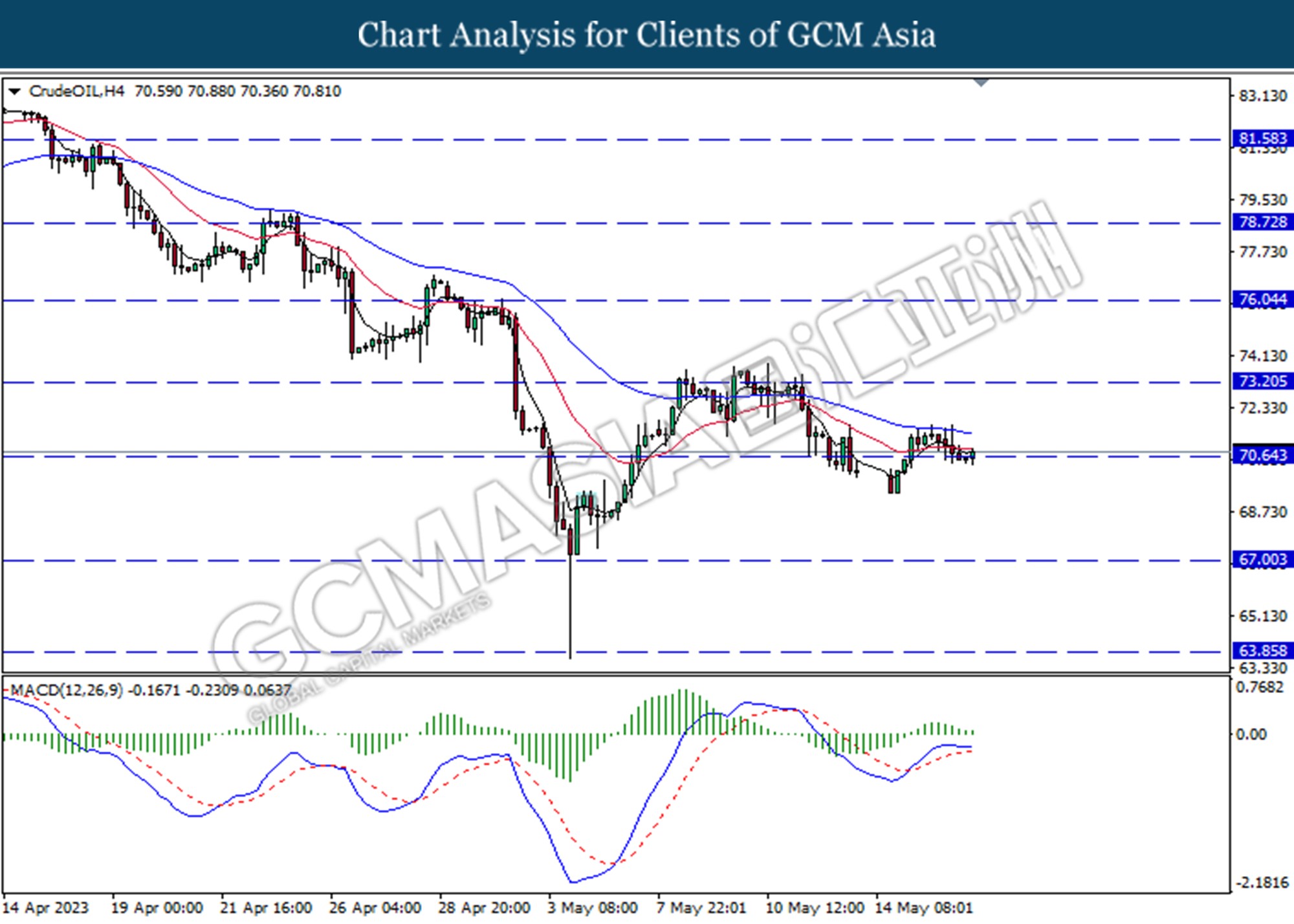

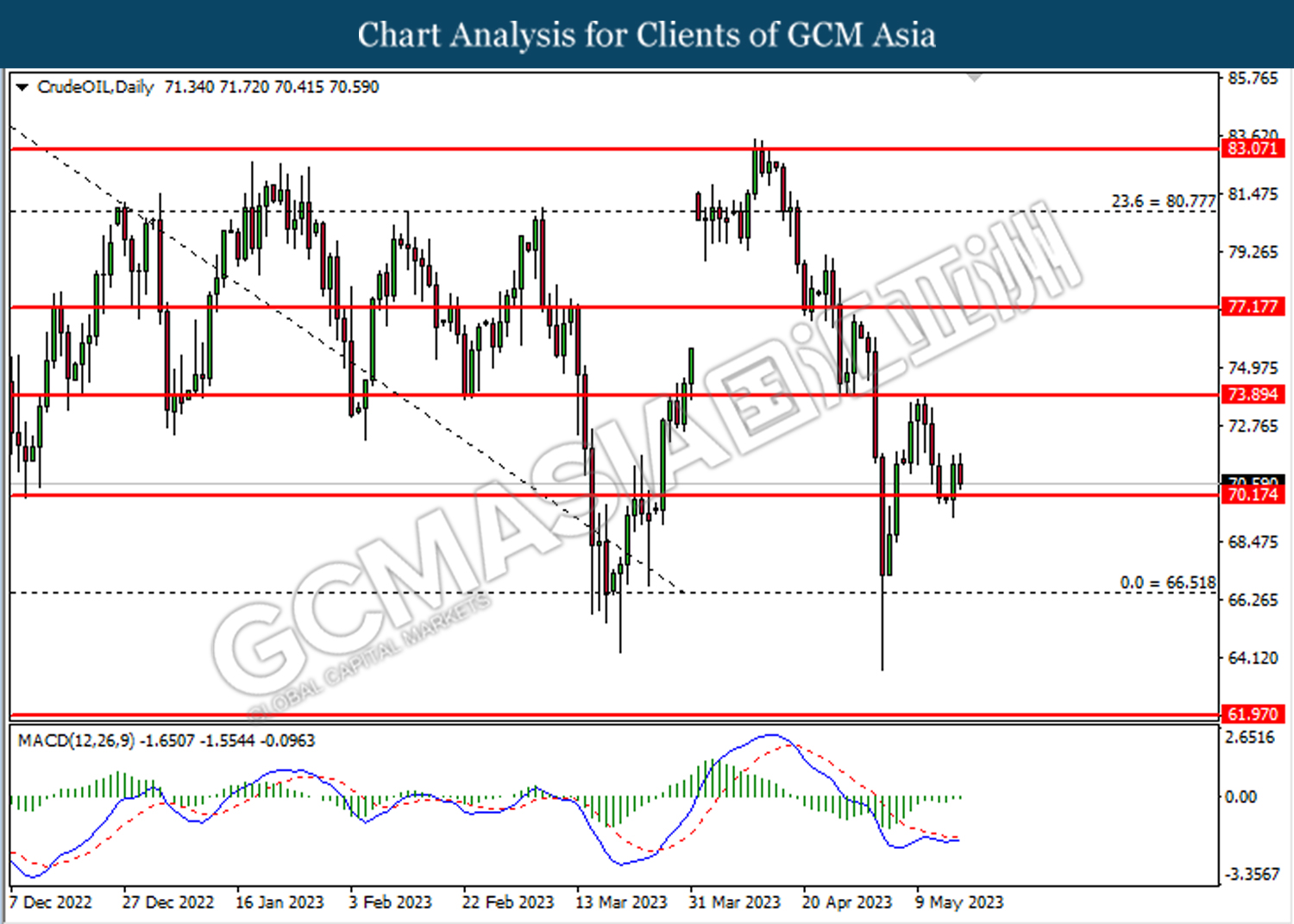

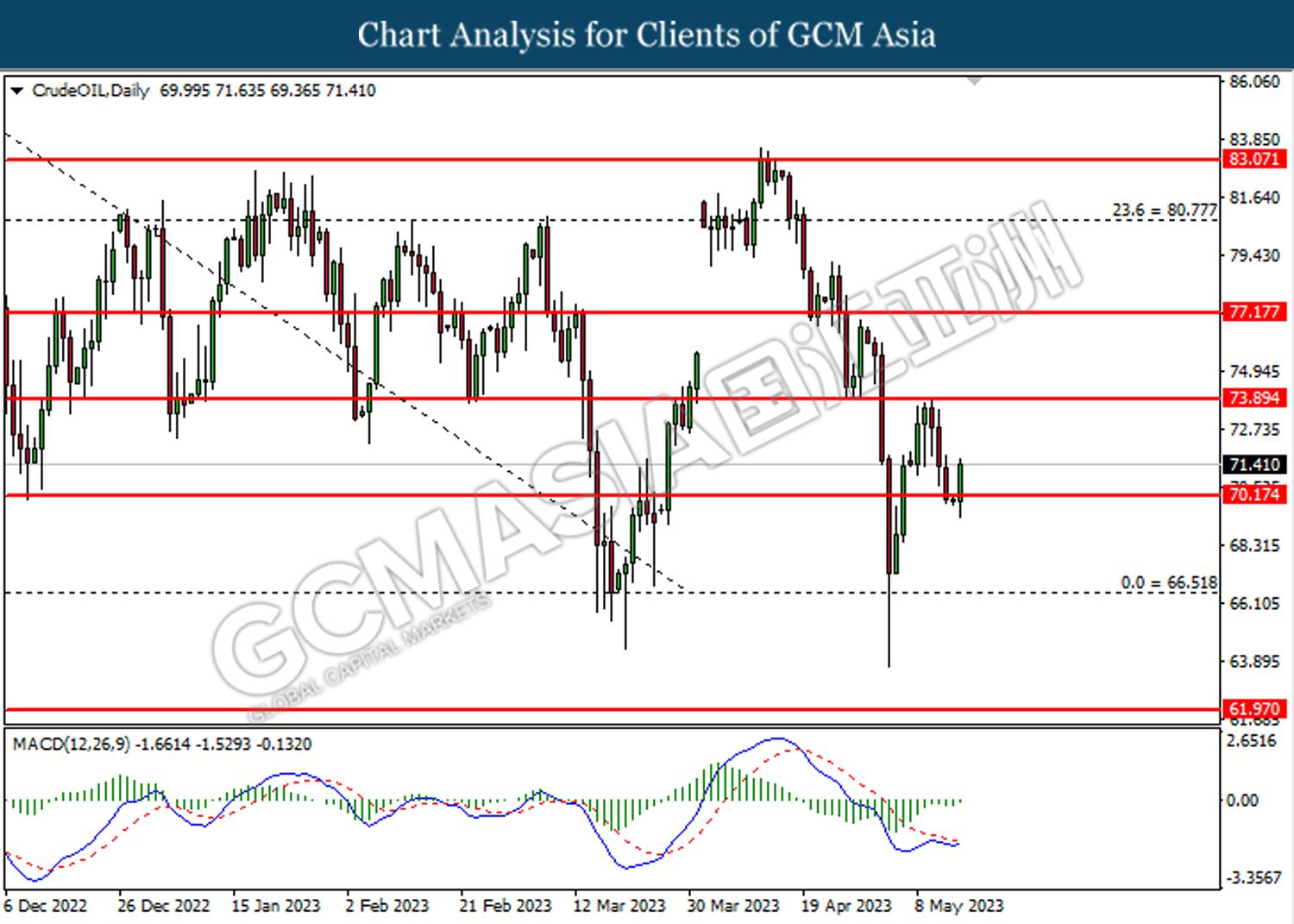

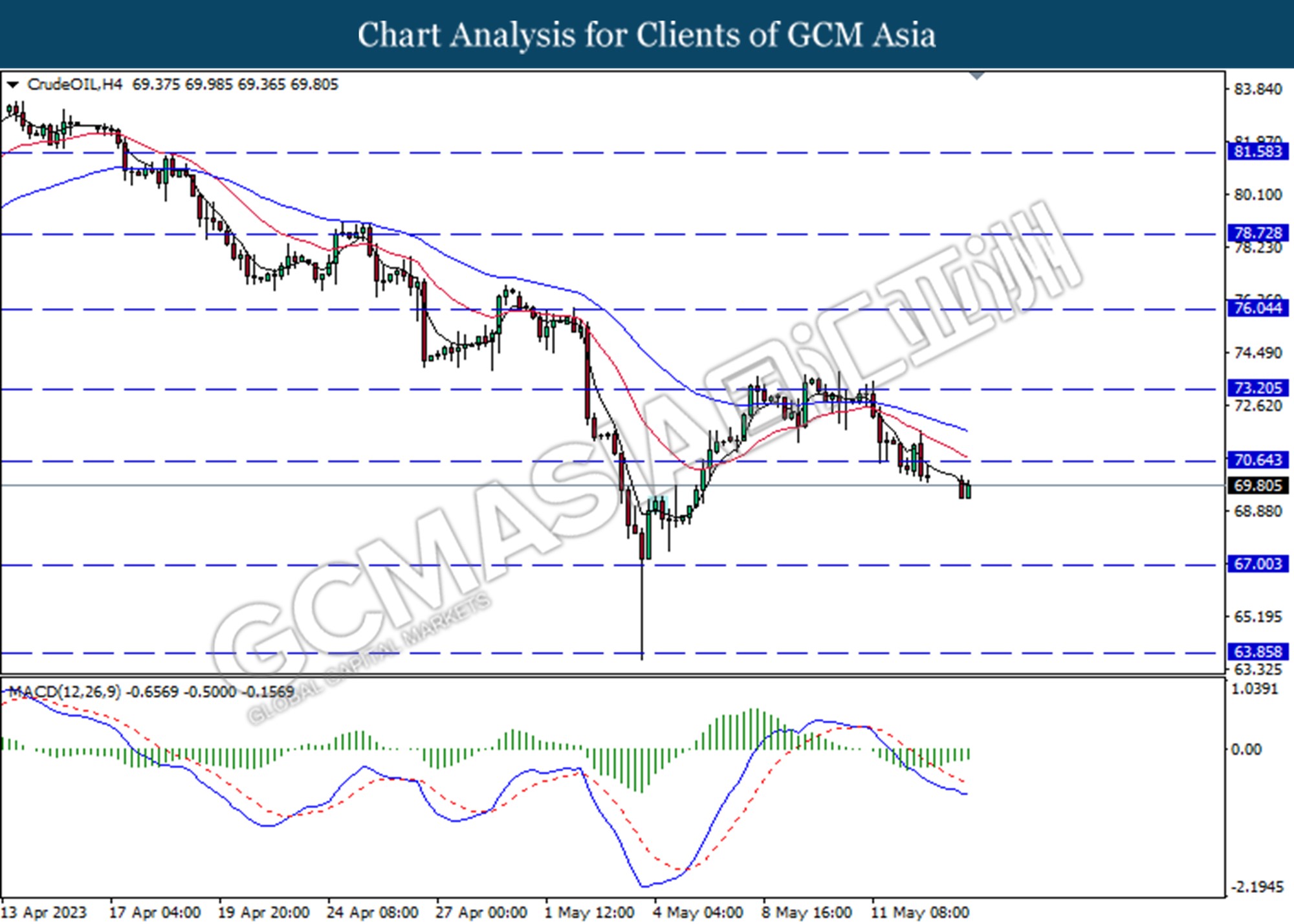

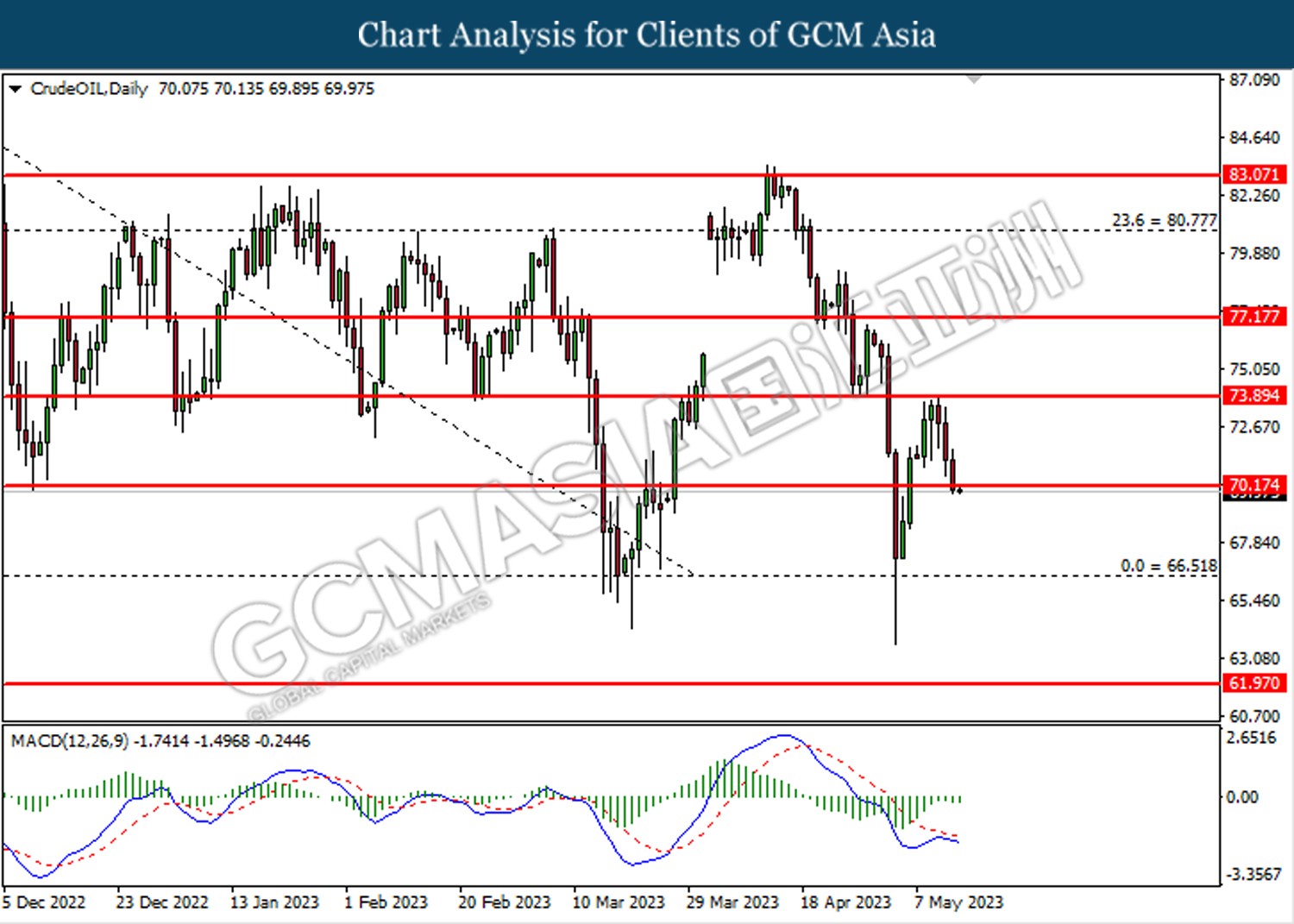

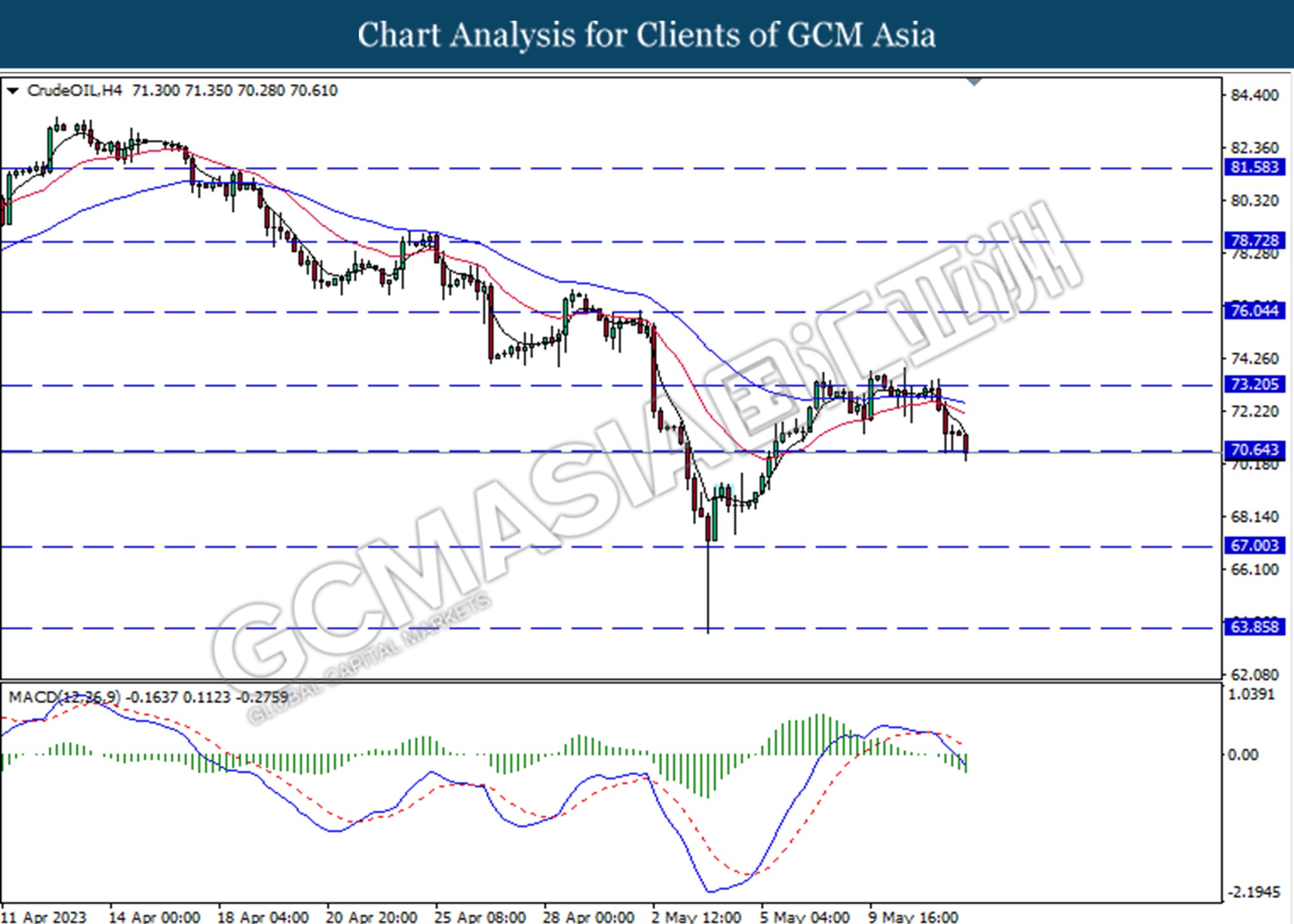

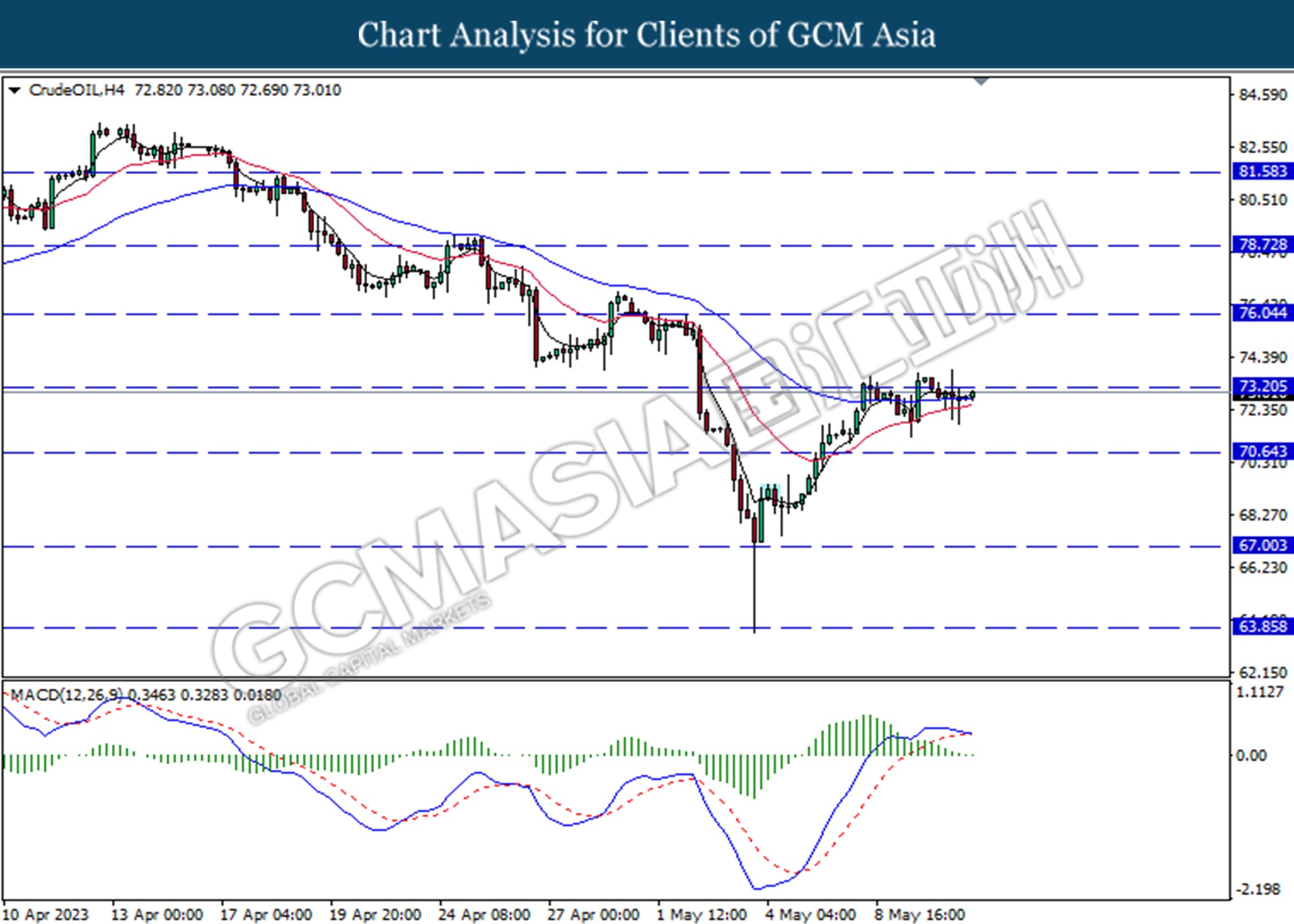

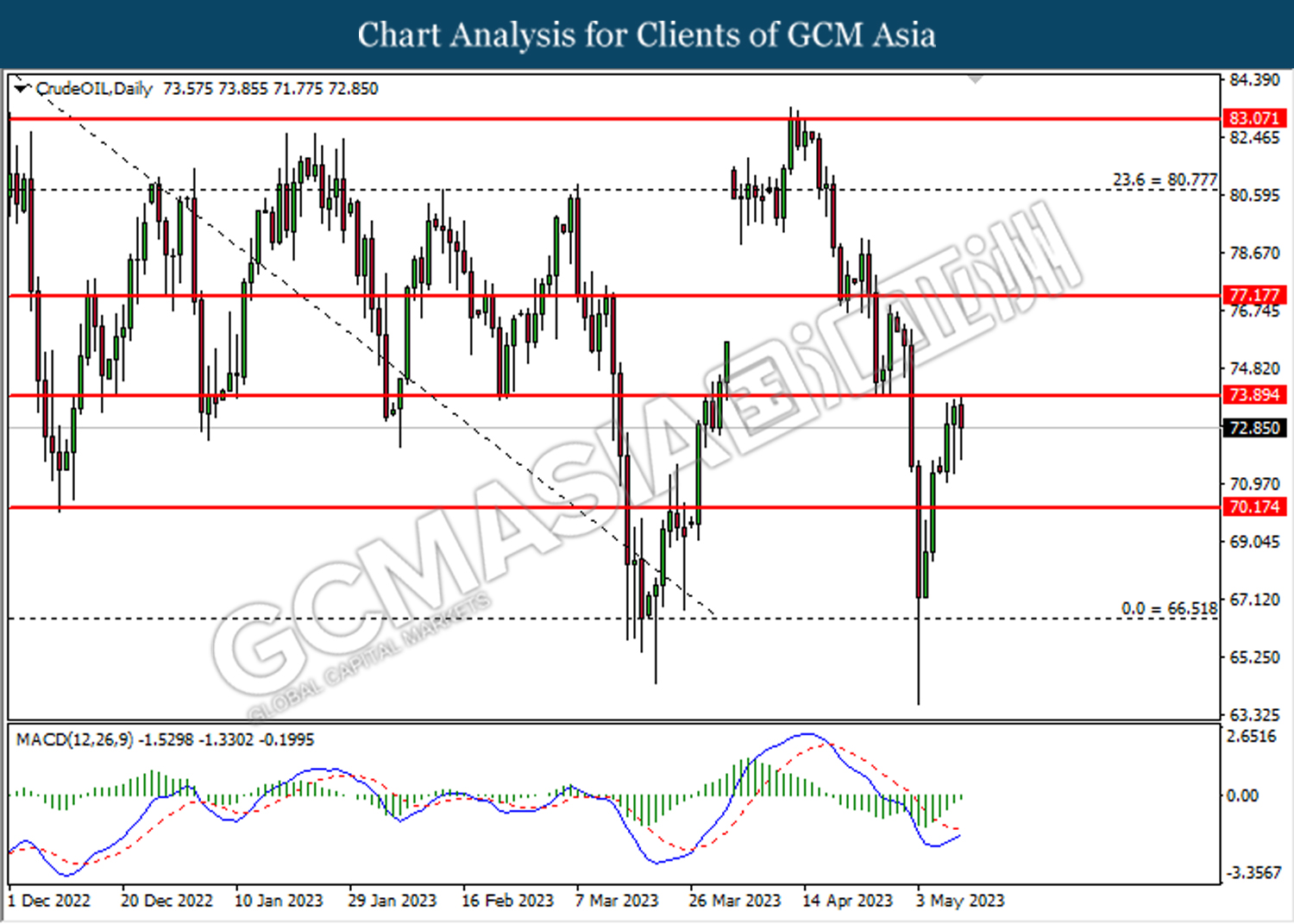

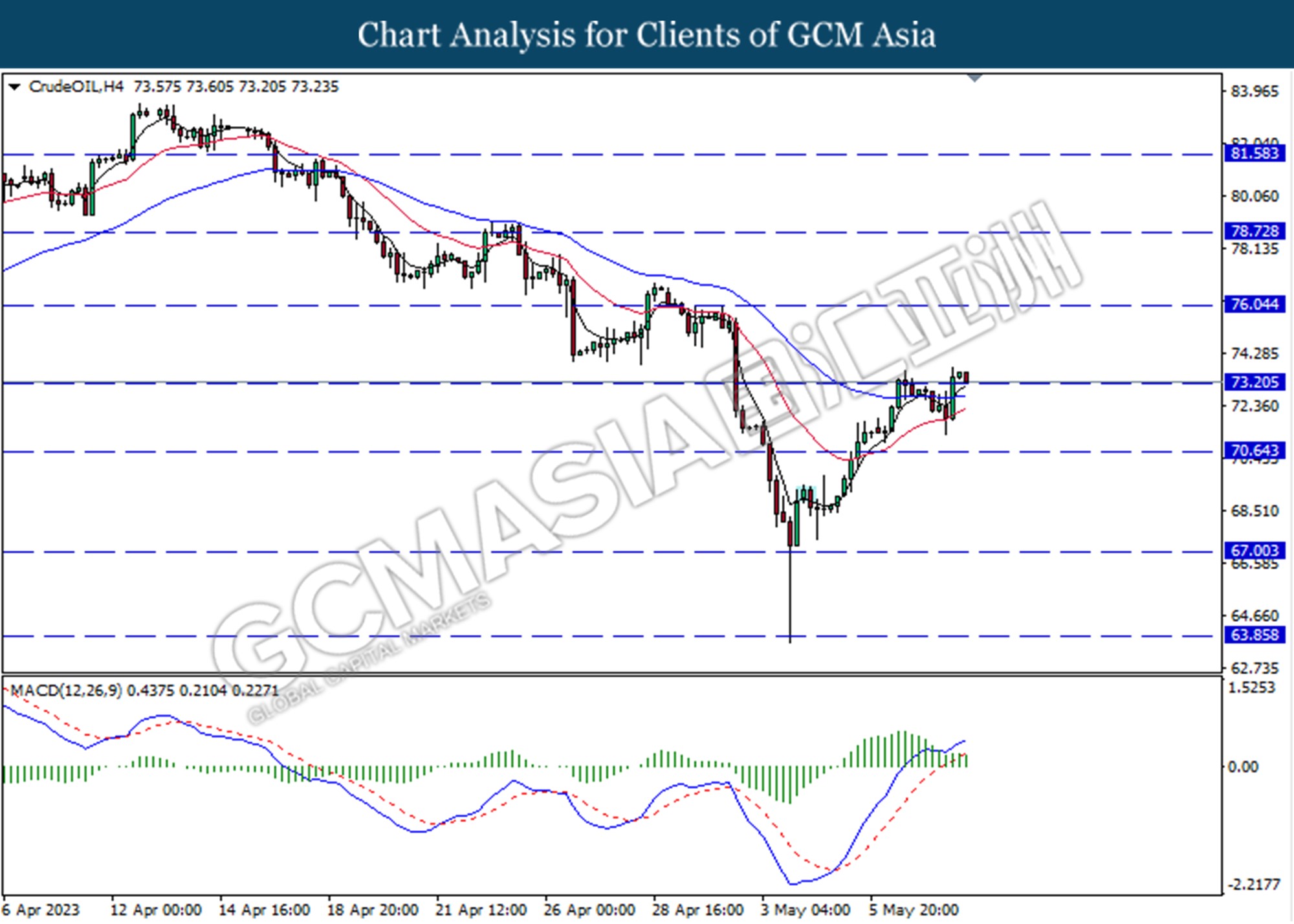

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

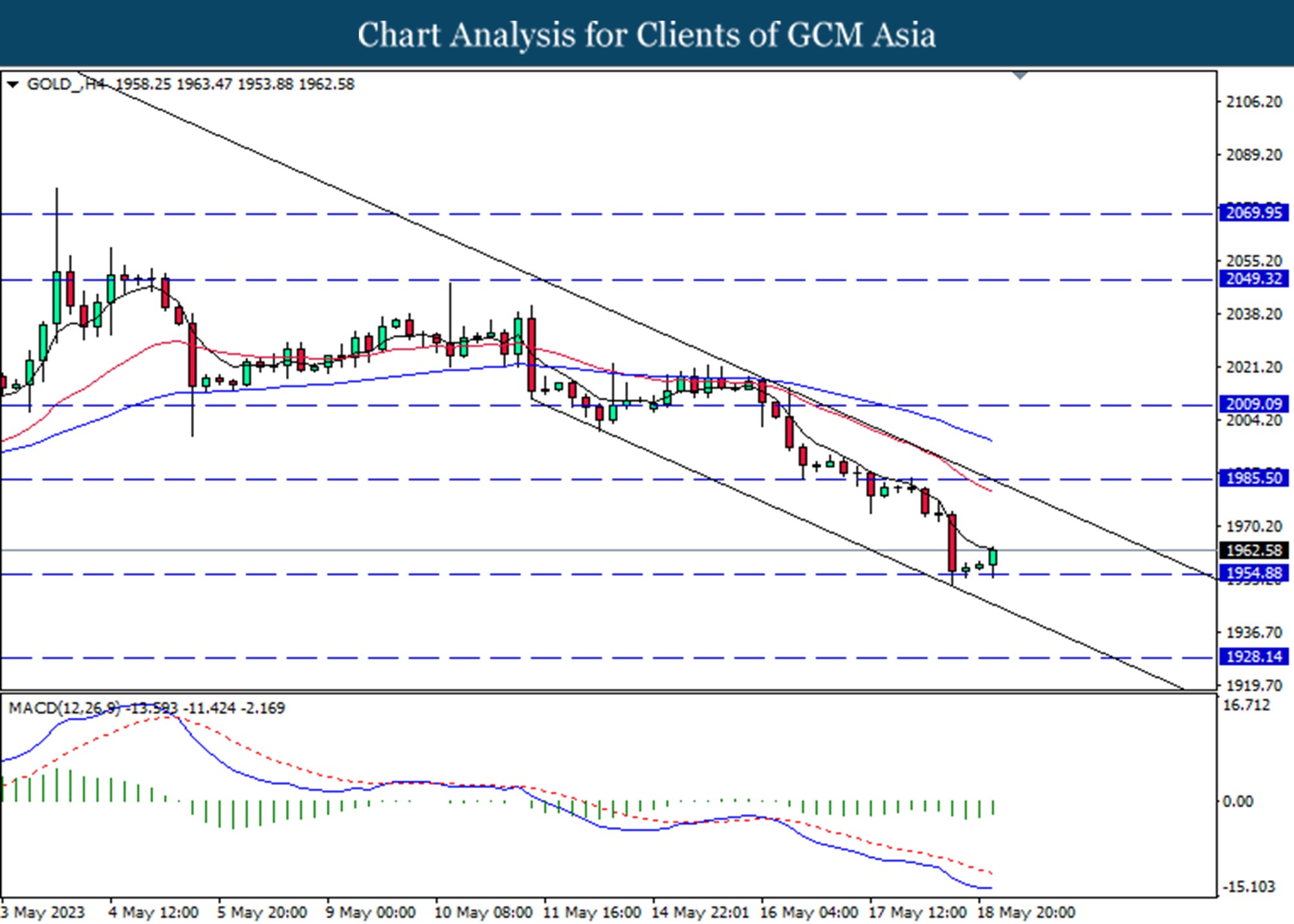

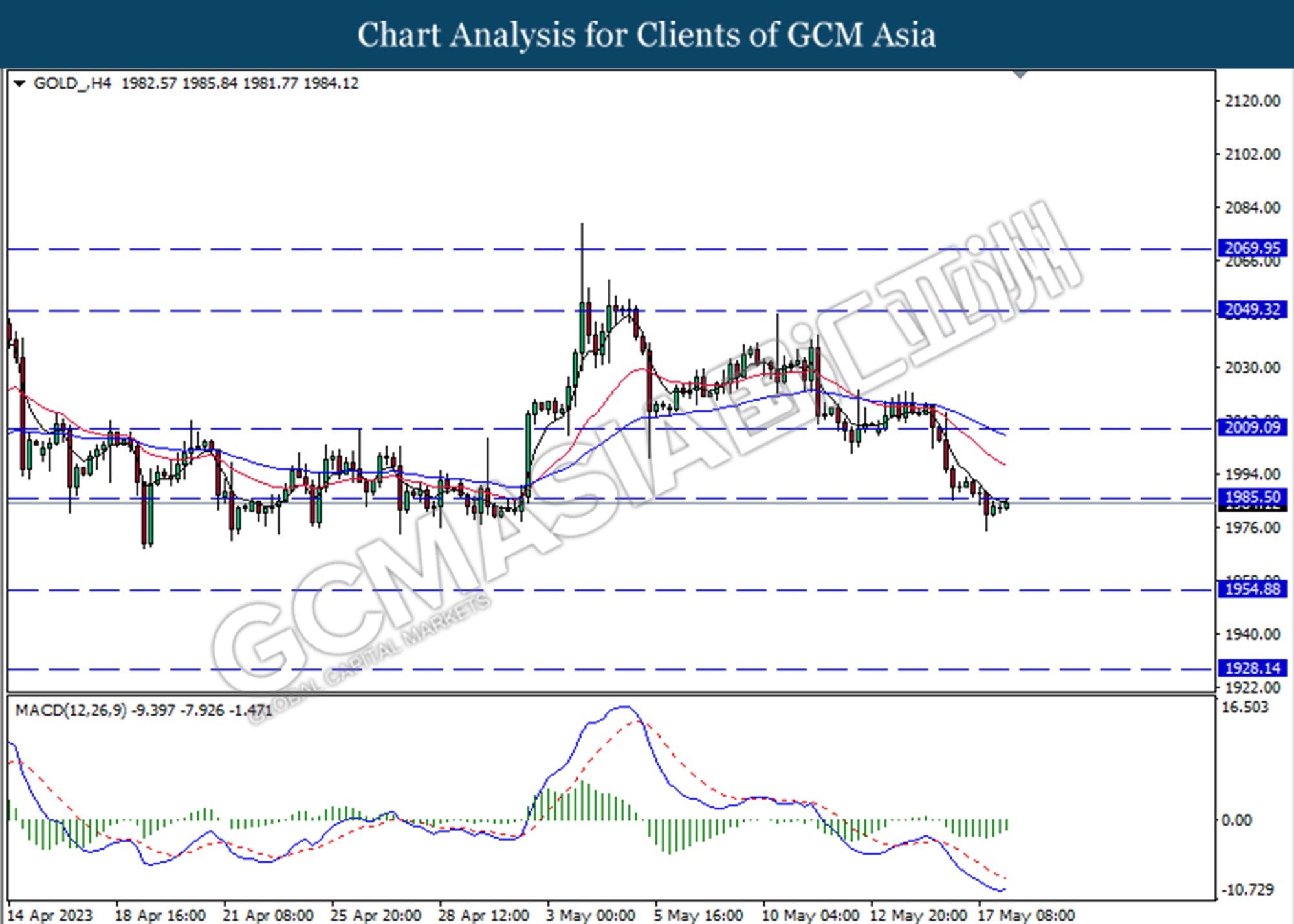

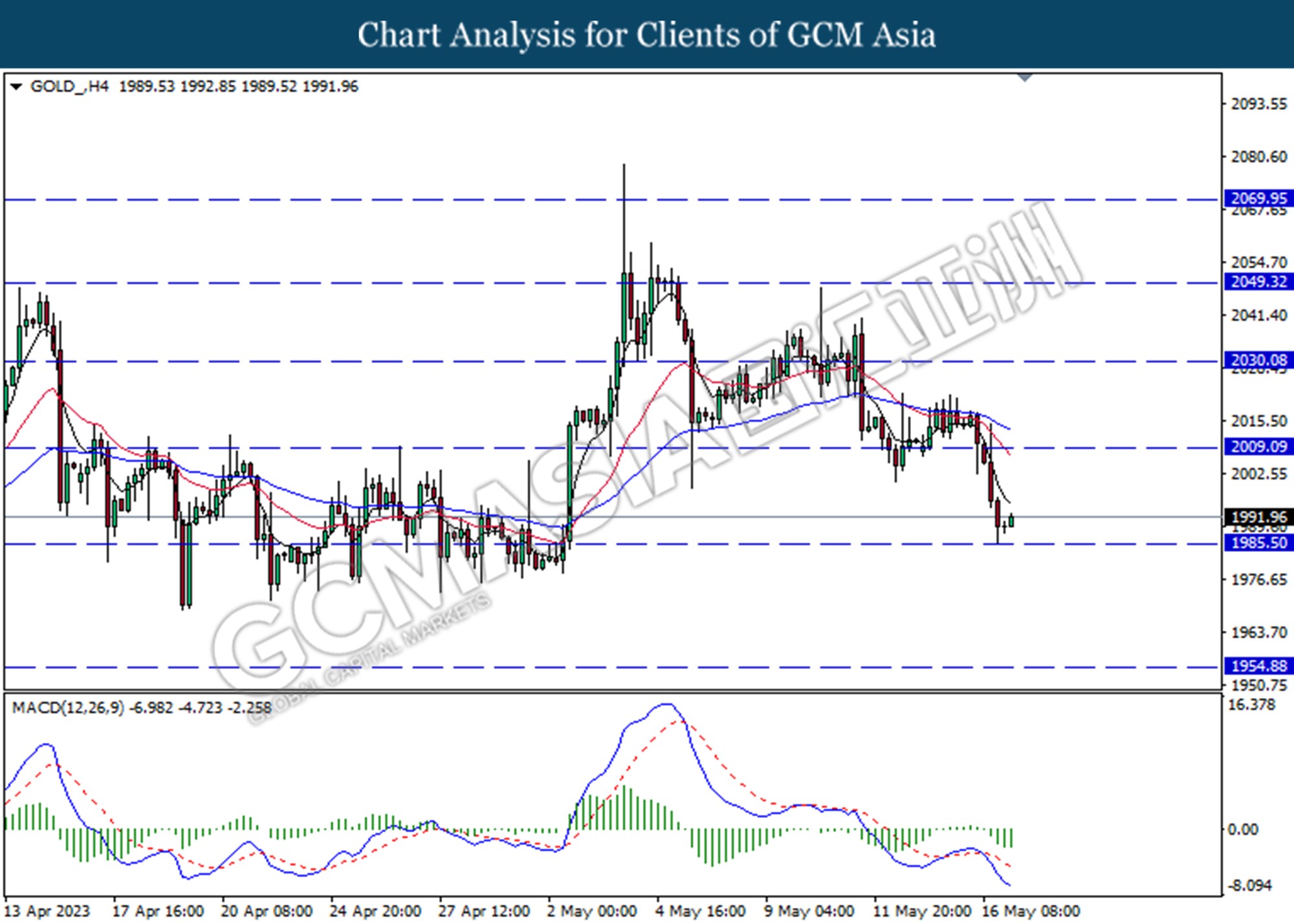

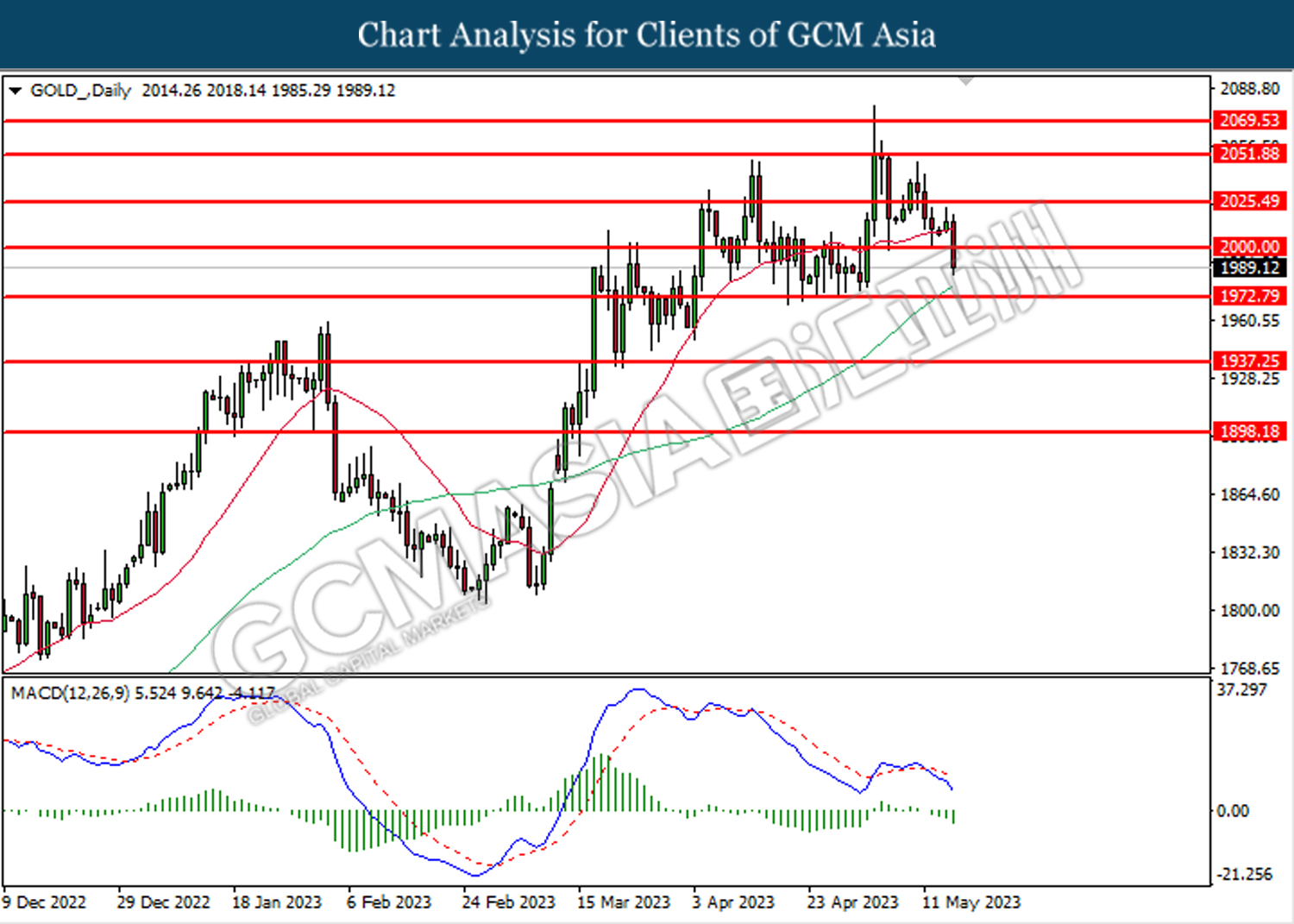

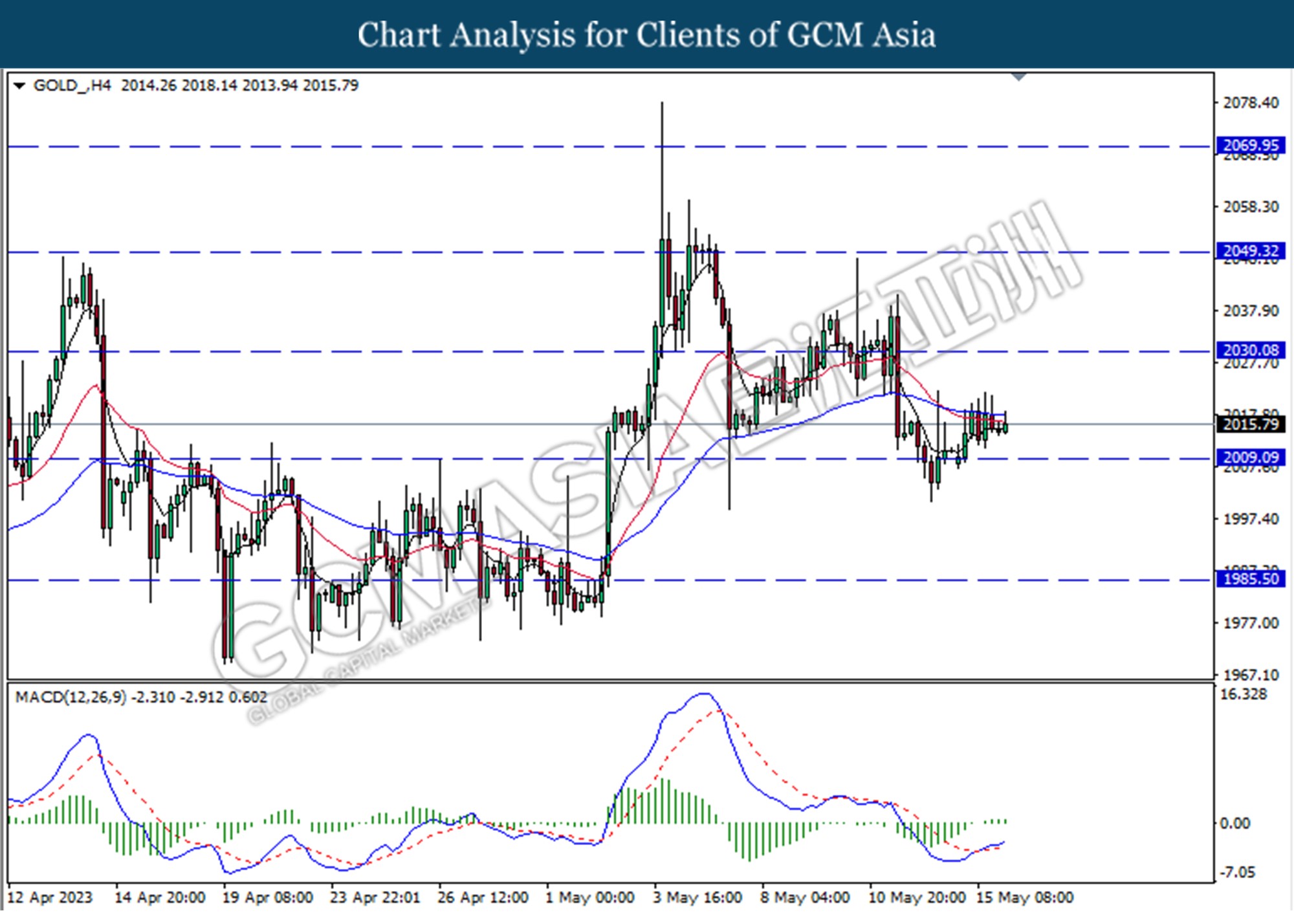

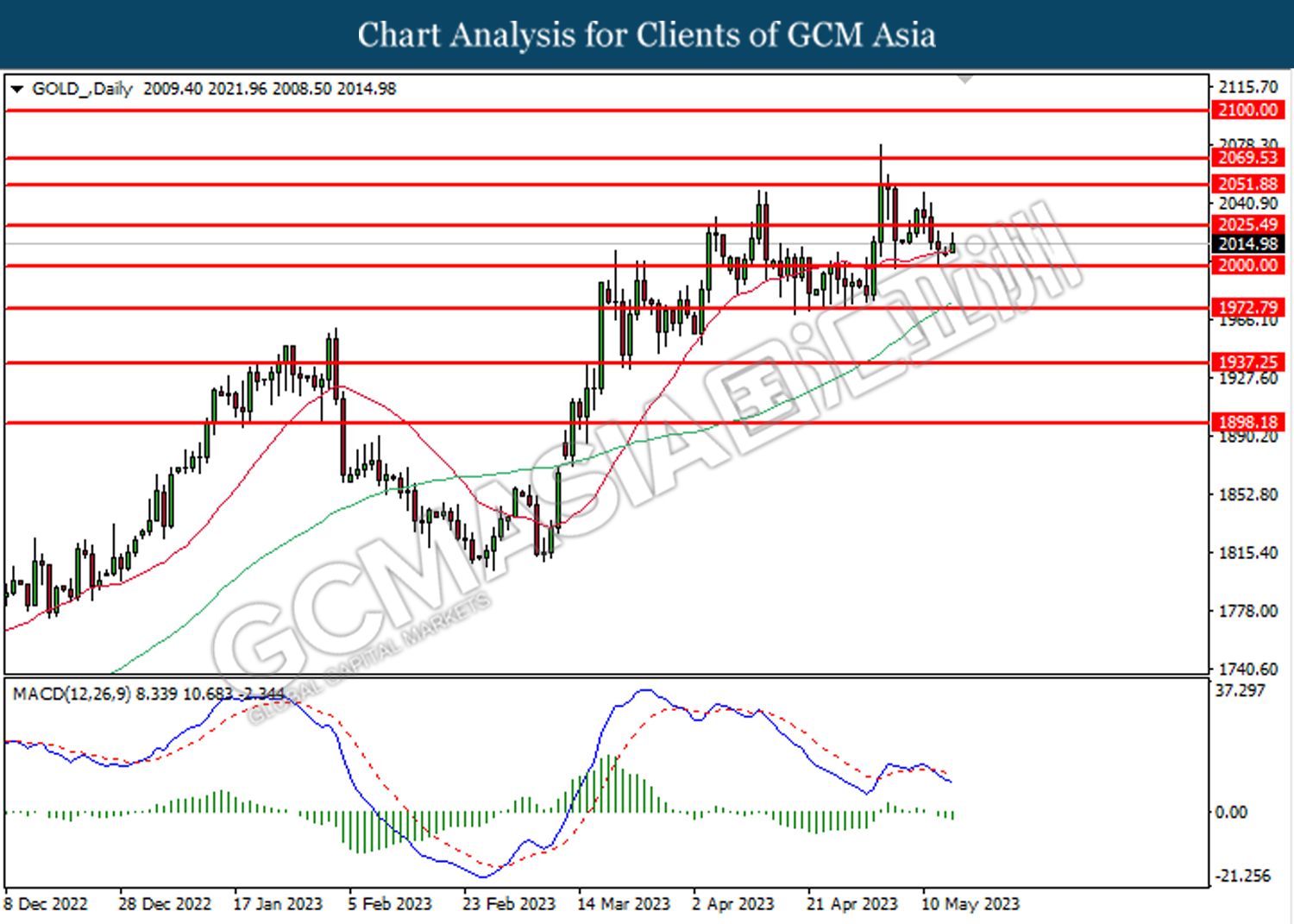

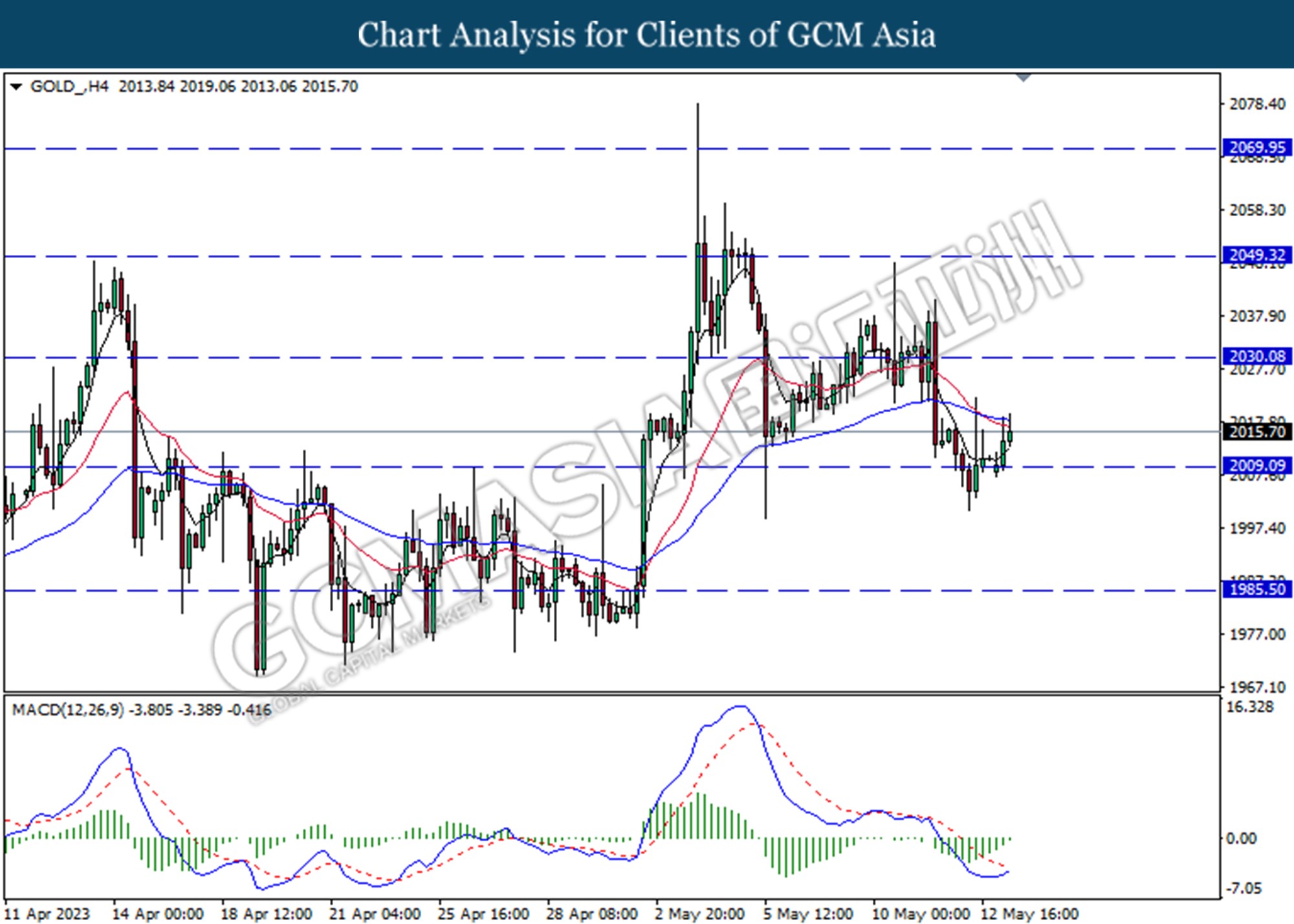

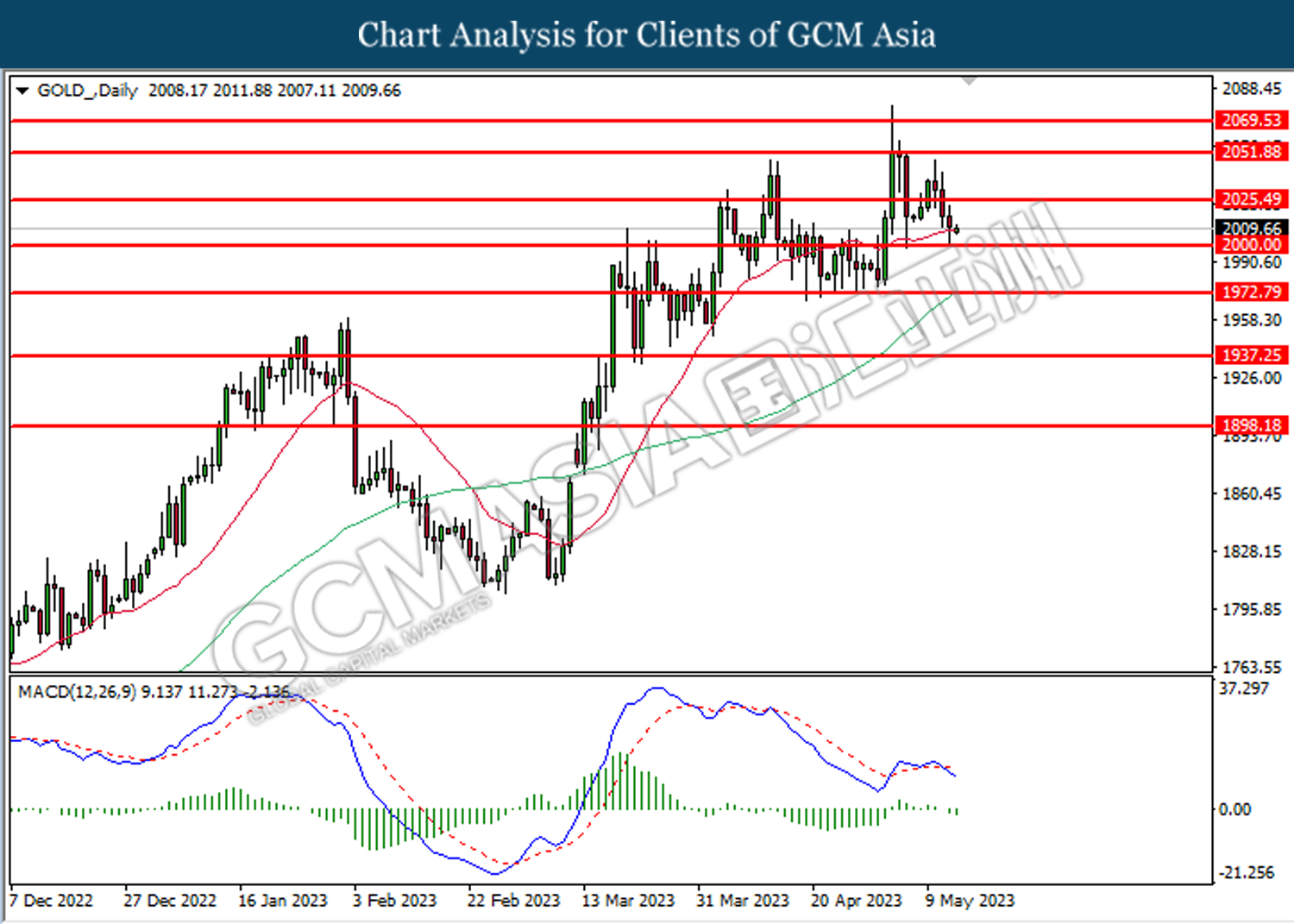

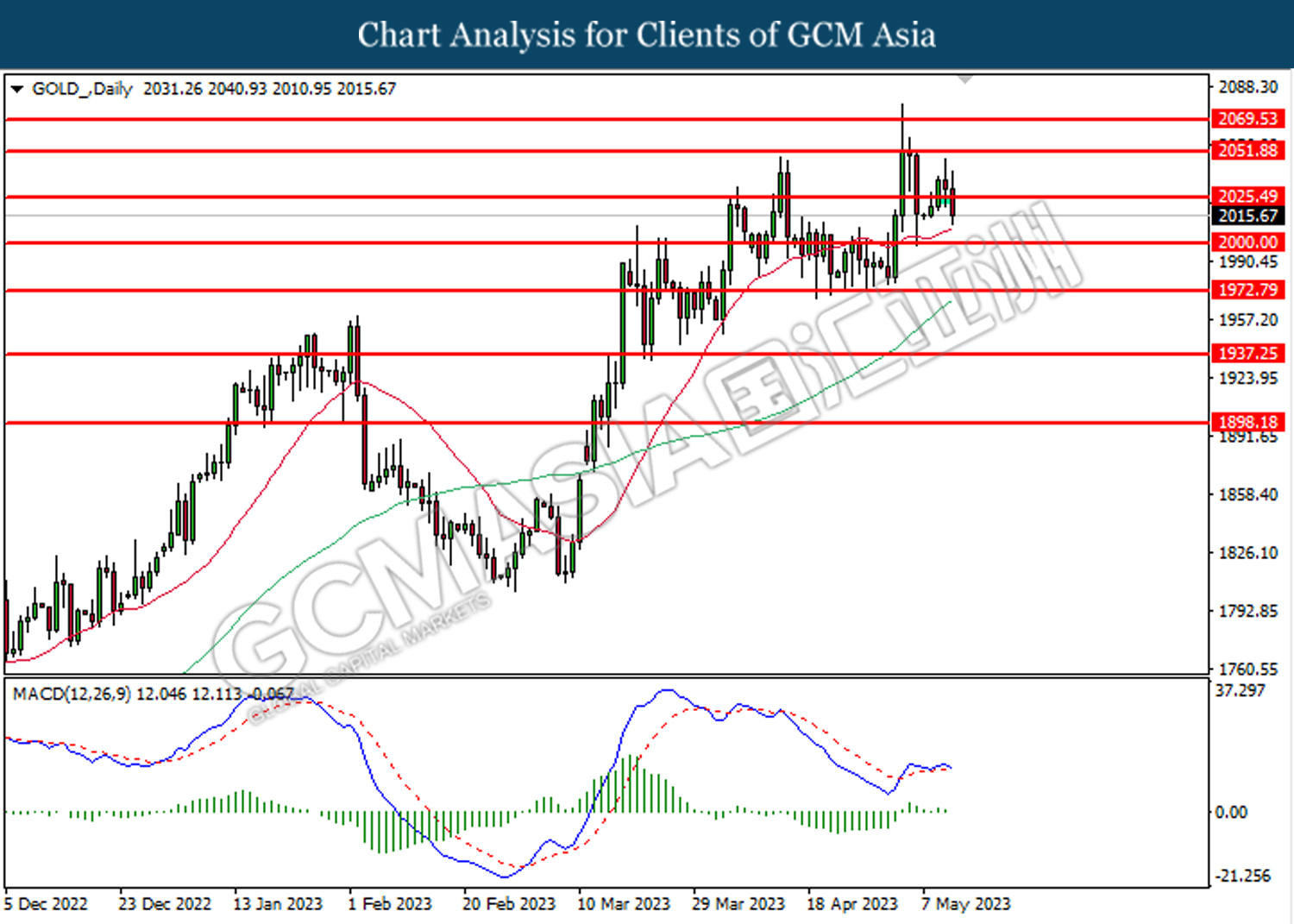

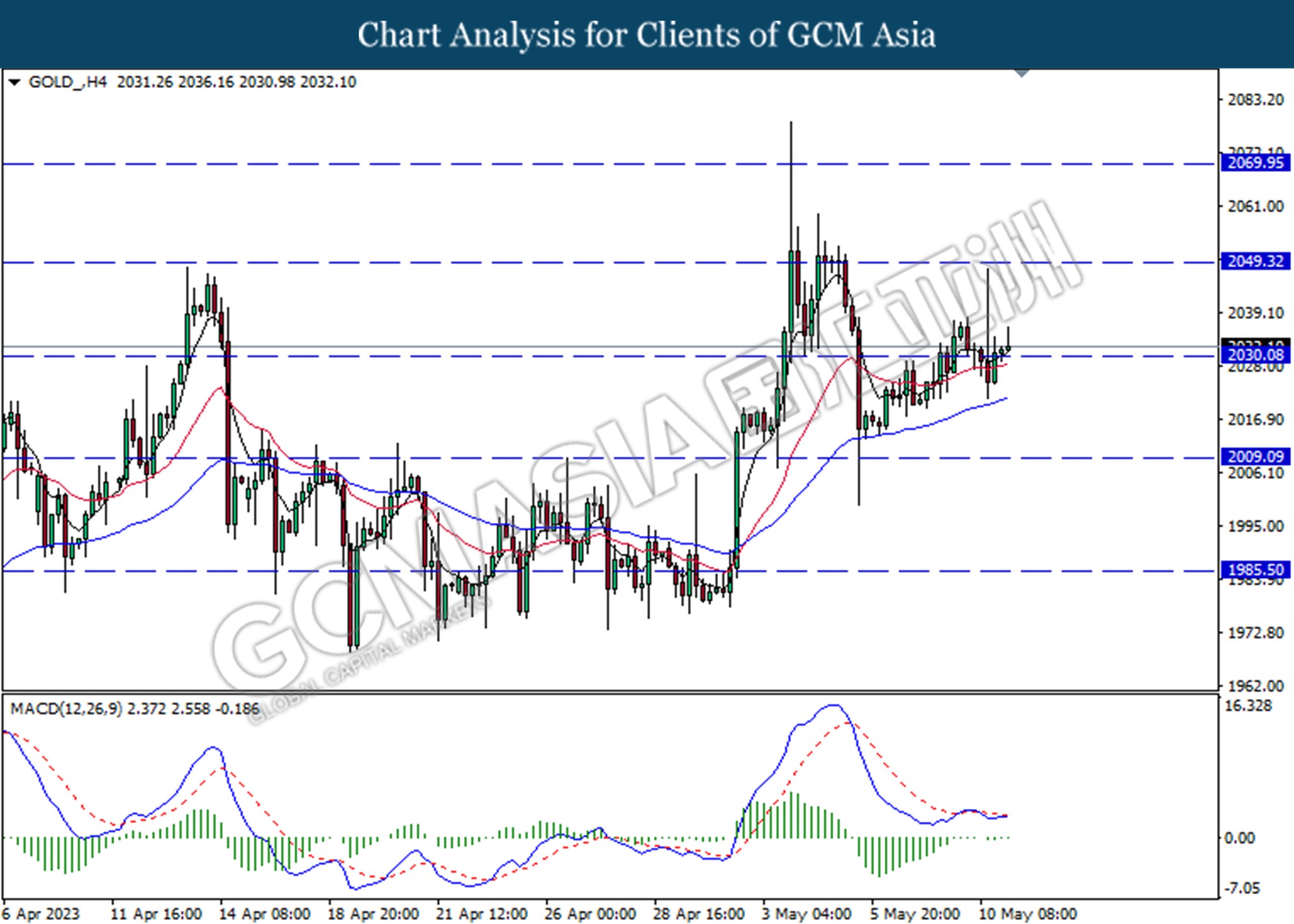

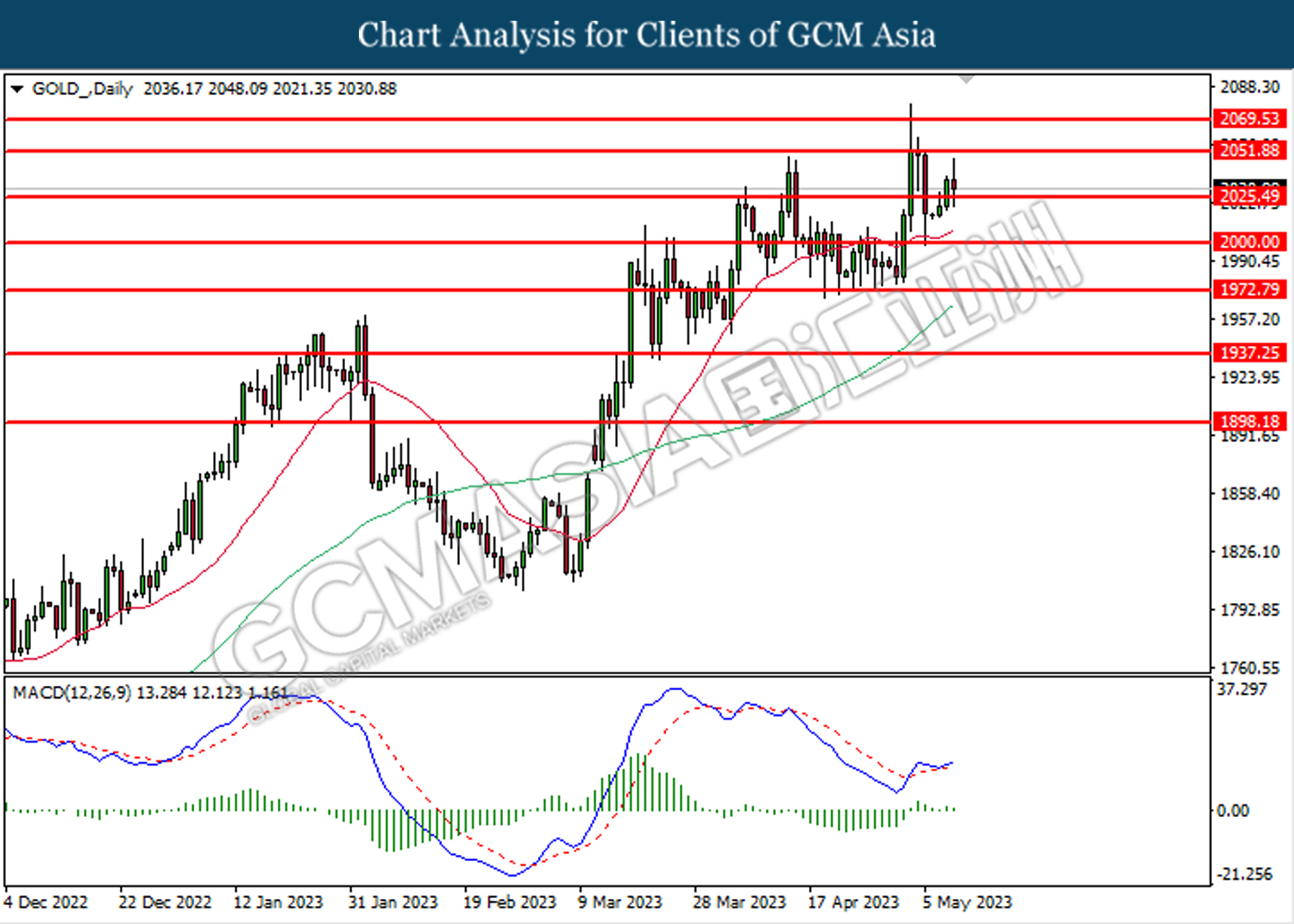

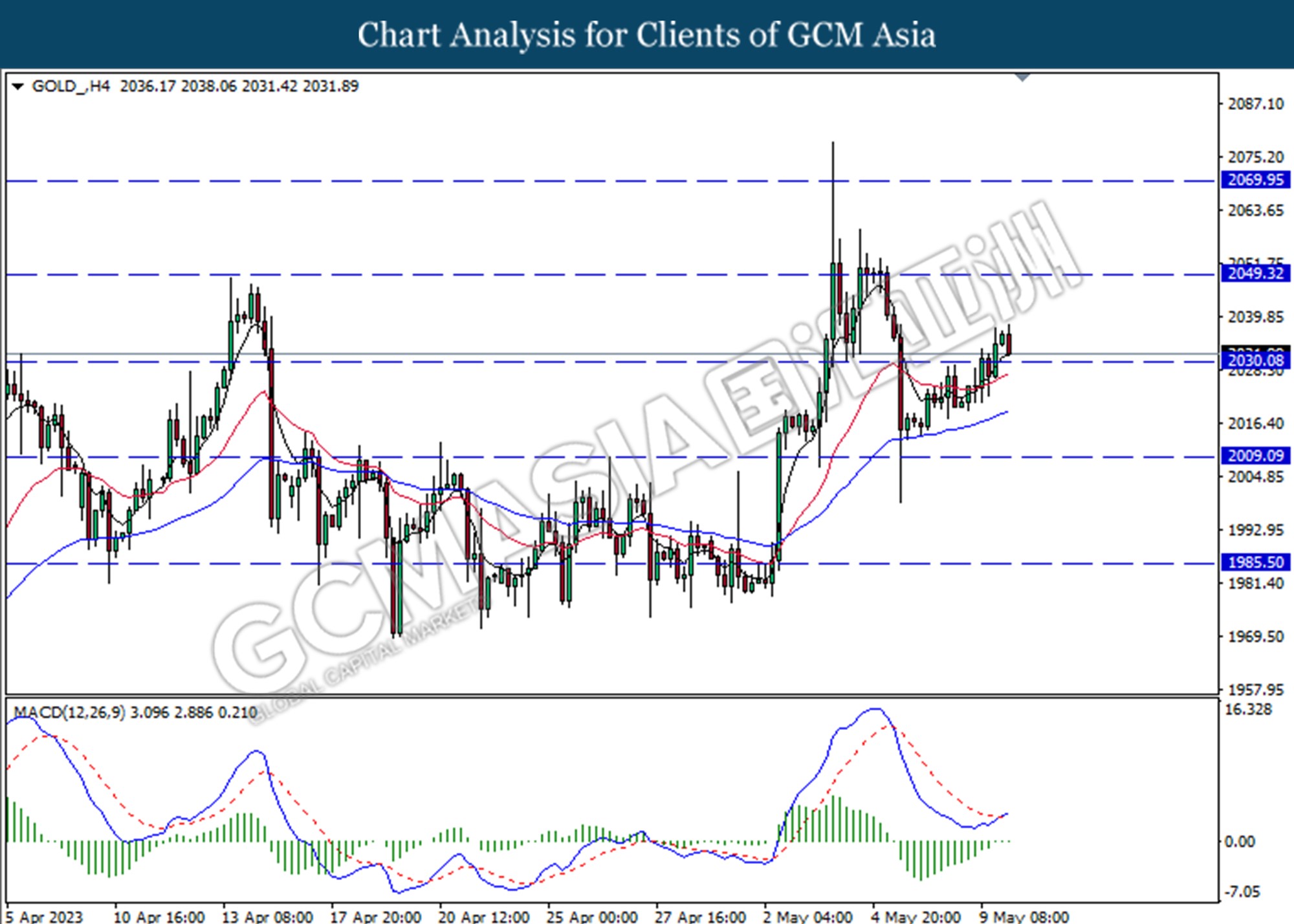

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1954.90. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1828.15

190523 Morning Session Analysis

19 May 2023 Morning Session Analysis

US dollar spiked amid a series of upbeat economic data.

The dollar index, which was traded against a basket of six major currencies, extended its gains during the yesterday’s trading session as a new round of solid economic data reignited the market confidence toward the currency. According to the Department of Labor, the number of American filed for unemployment claims in the past week fell more than expected, suggesting the labor market remains tight. The initial claims for unemployment benefits dropped from the prior reading’s 264K to 242K this week, lower than the consensus forecast at 254K. With this figure, it pared back the bet of further easing monetary policy as the ongoing labor market situation provided some room for Federal Reserve to hike its rate again if necessary. Besides, the Federal Reserve Bank of Philadelphia posted the manufacturing index for the month of May at -10.4, slightly better than the consensus forecast at -19.8, indicating some improvement in the manufacturing activity although it is still continued to decline in overall. With the backdrop of strong economic data and “constructive progress” in the talks of debt ceiling, the appeal of US dollar jumped and it hit the highest level in two months. As of writing, the dollar index rose 0.62% to 103.50.

In the commodities market, crude oil prices edged down by -0.78% to $72.15 per barrel as the solid US economic data boosted the value of dollar and prompted the investors to shy away from oil market temporarily. Besides, gold prices edged down -0.06% to $1958.75 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | -0.7% | -0.8% | – |

Technical Analysis

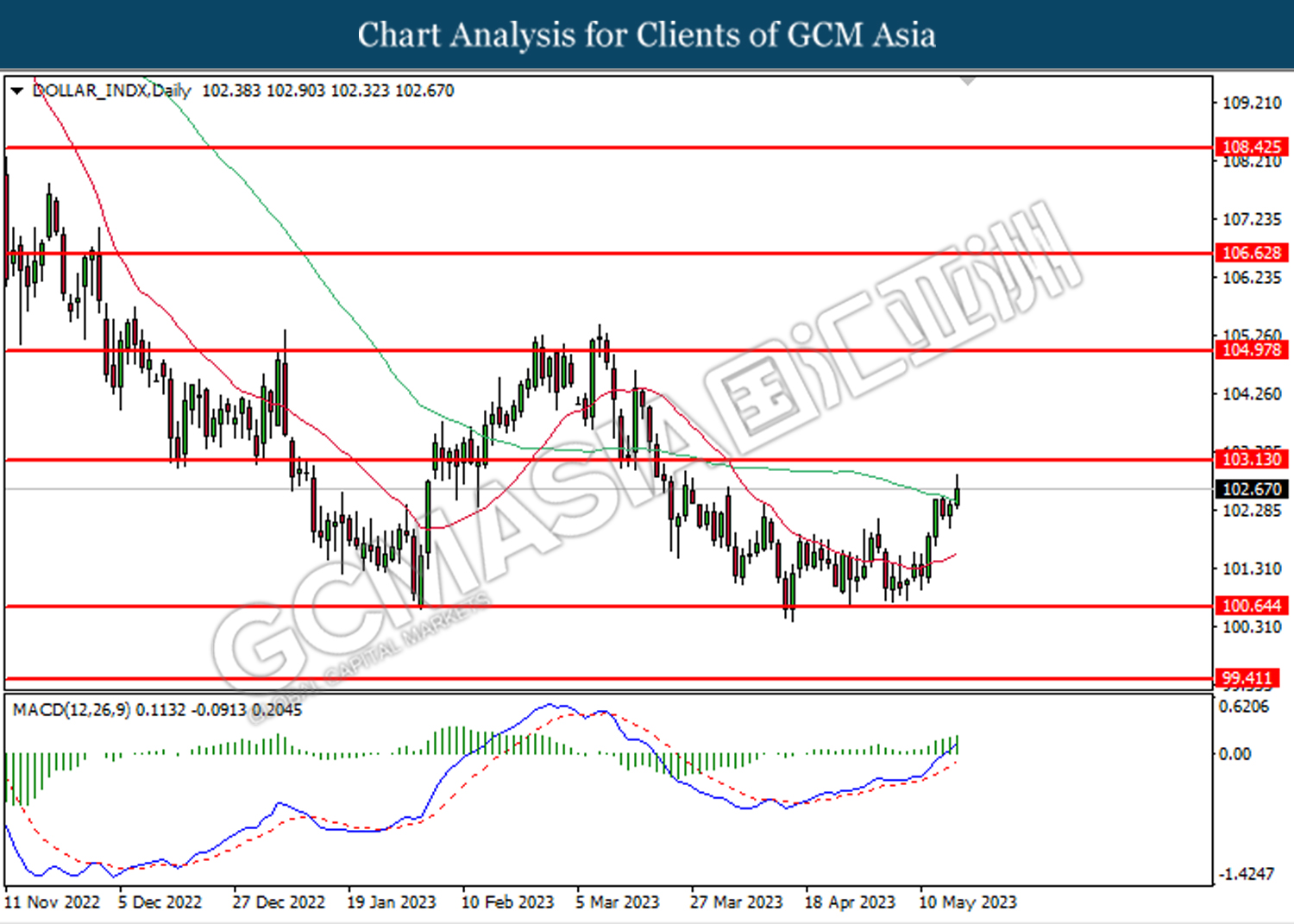

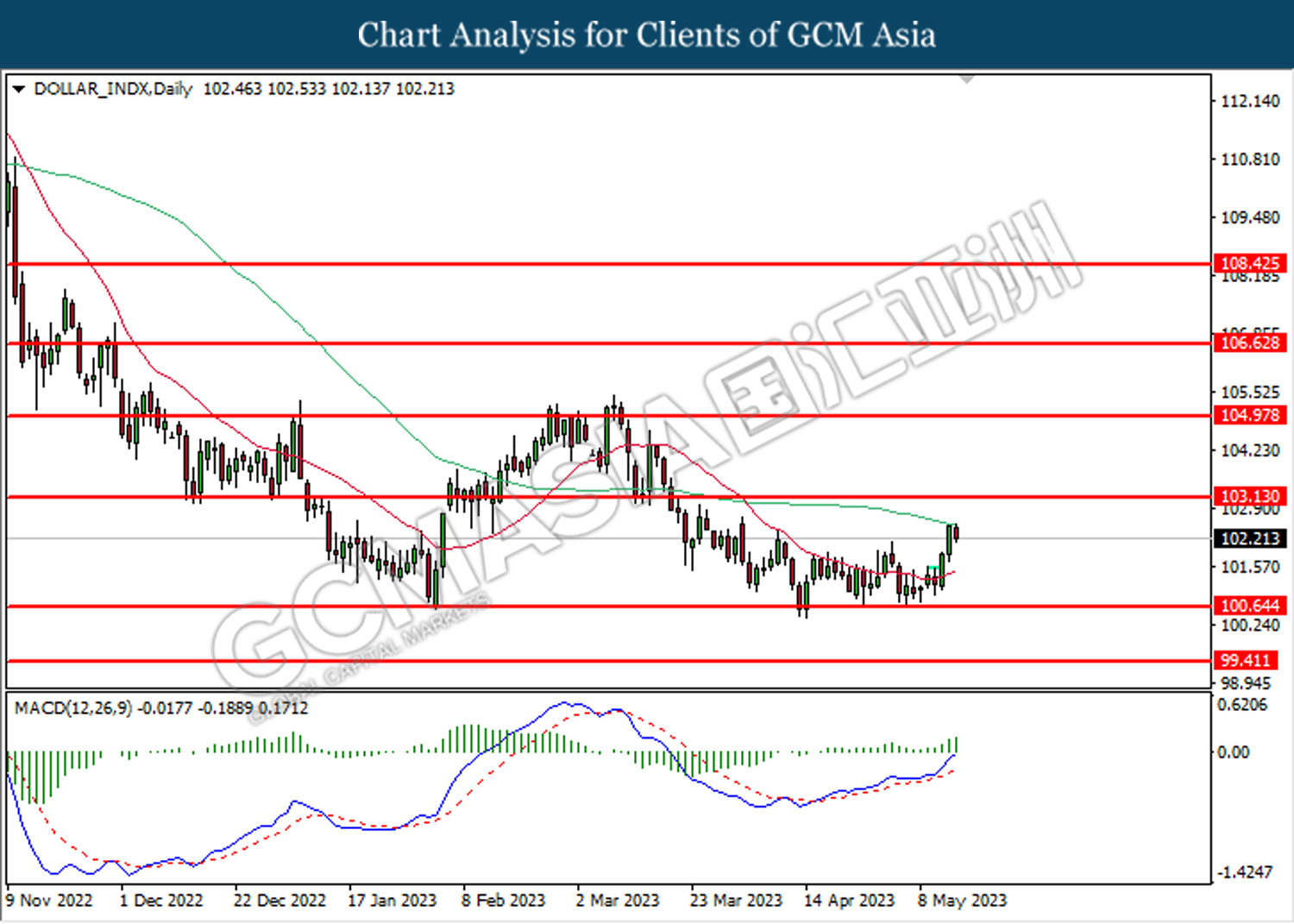

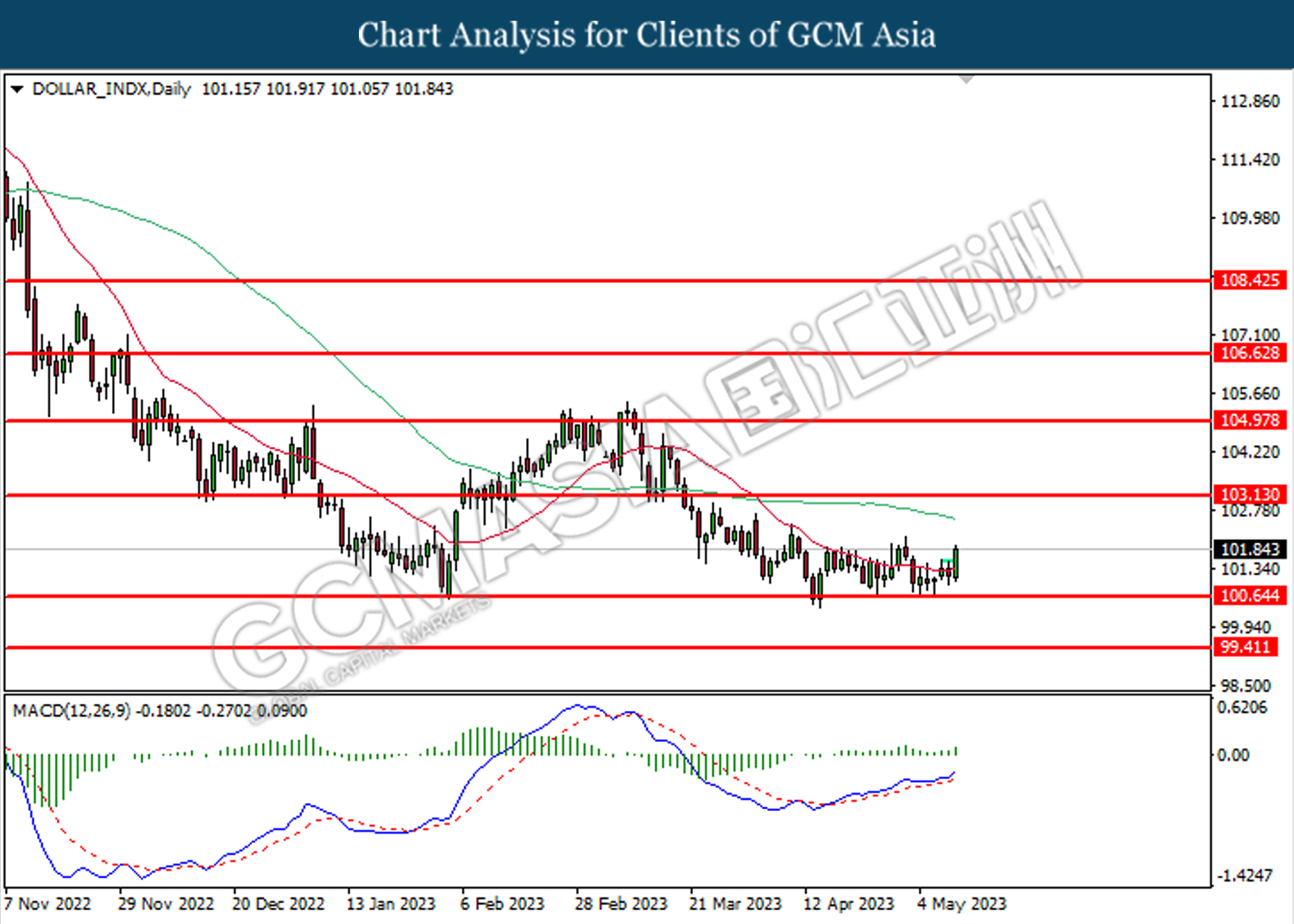

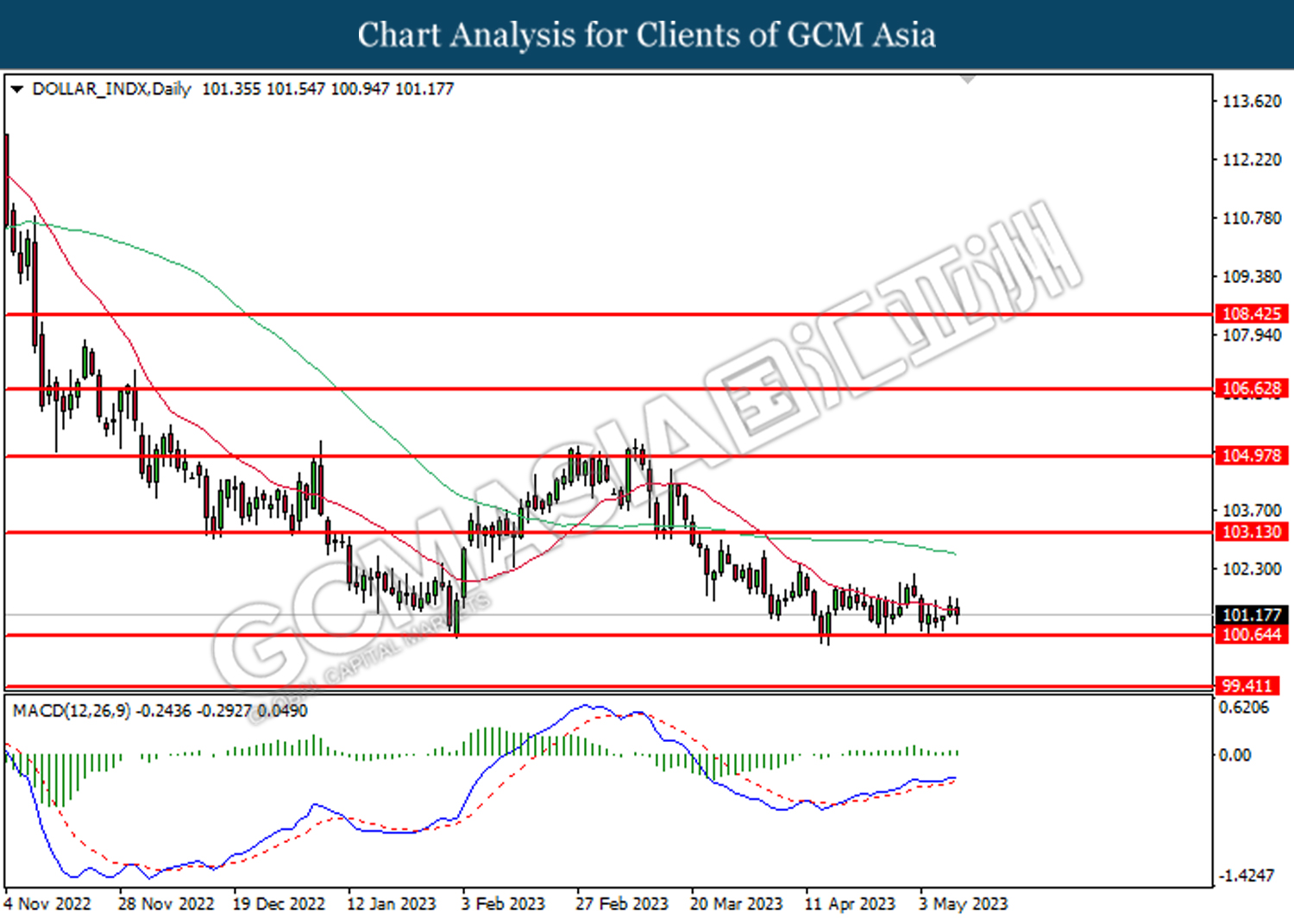

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

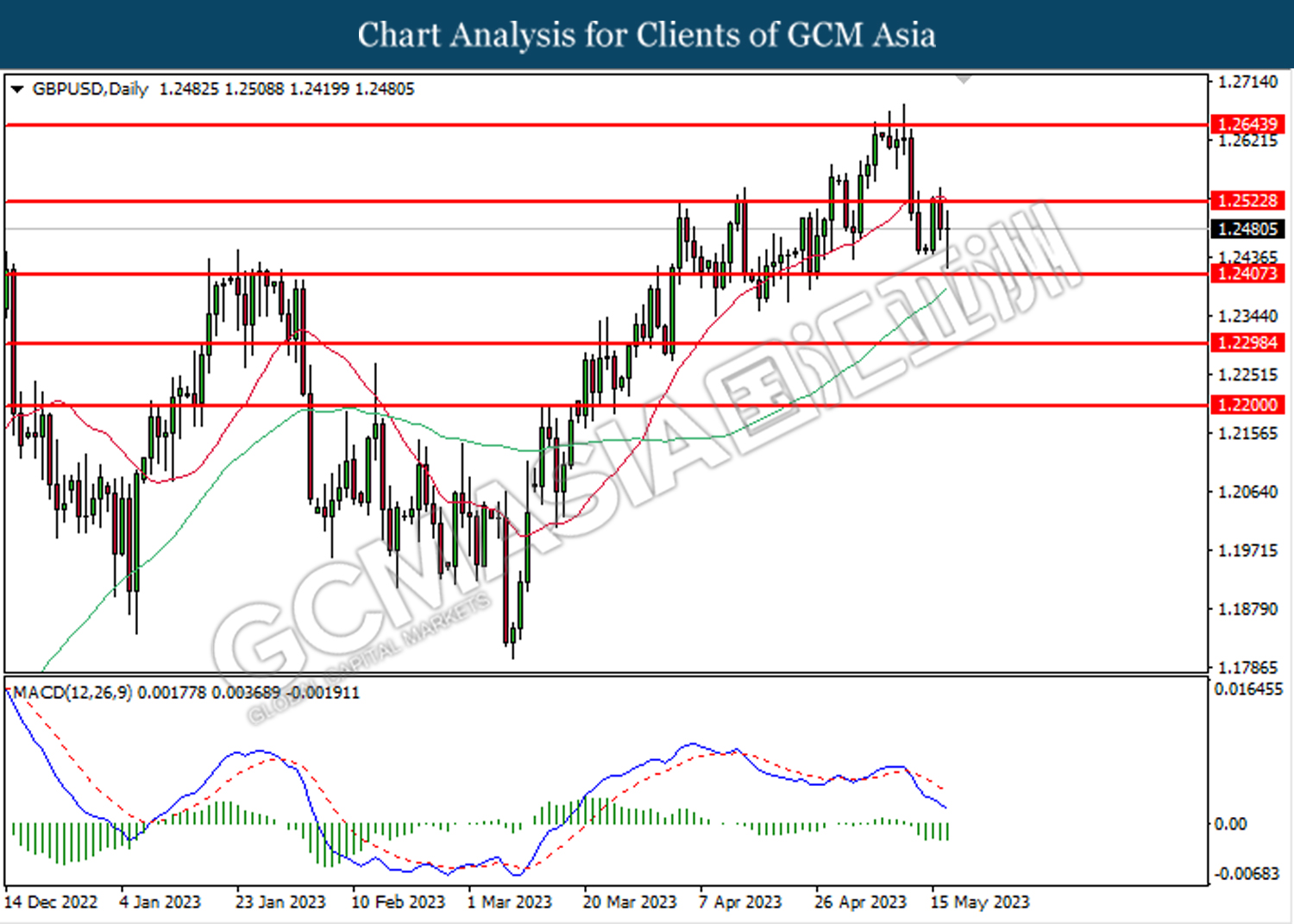

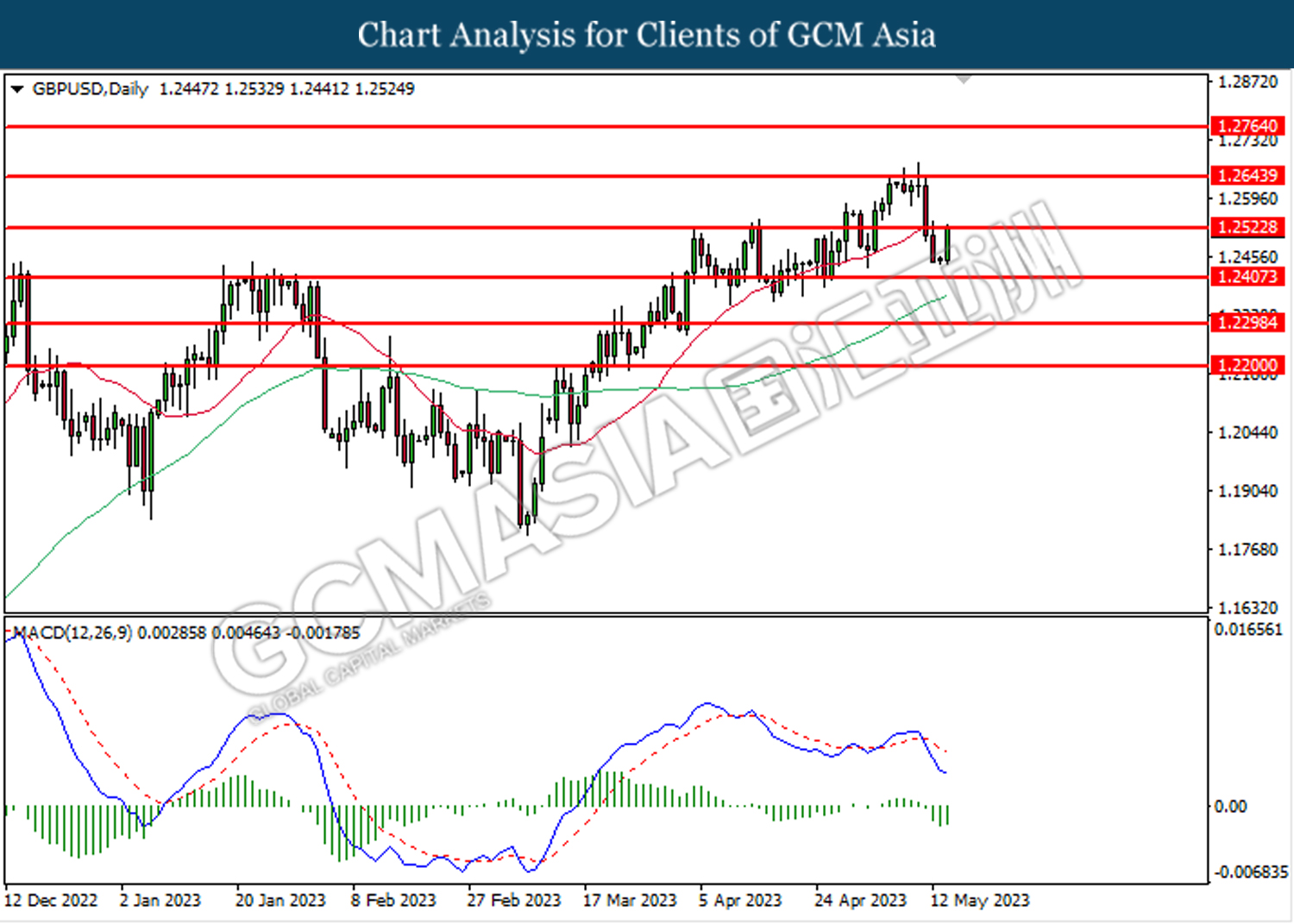

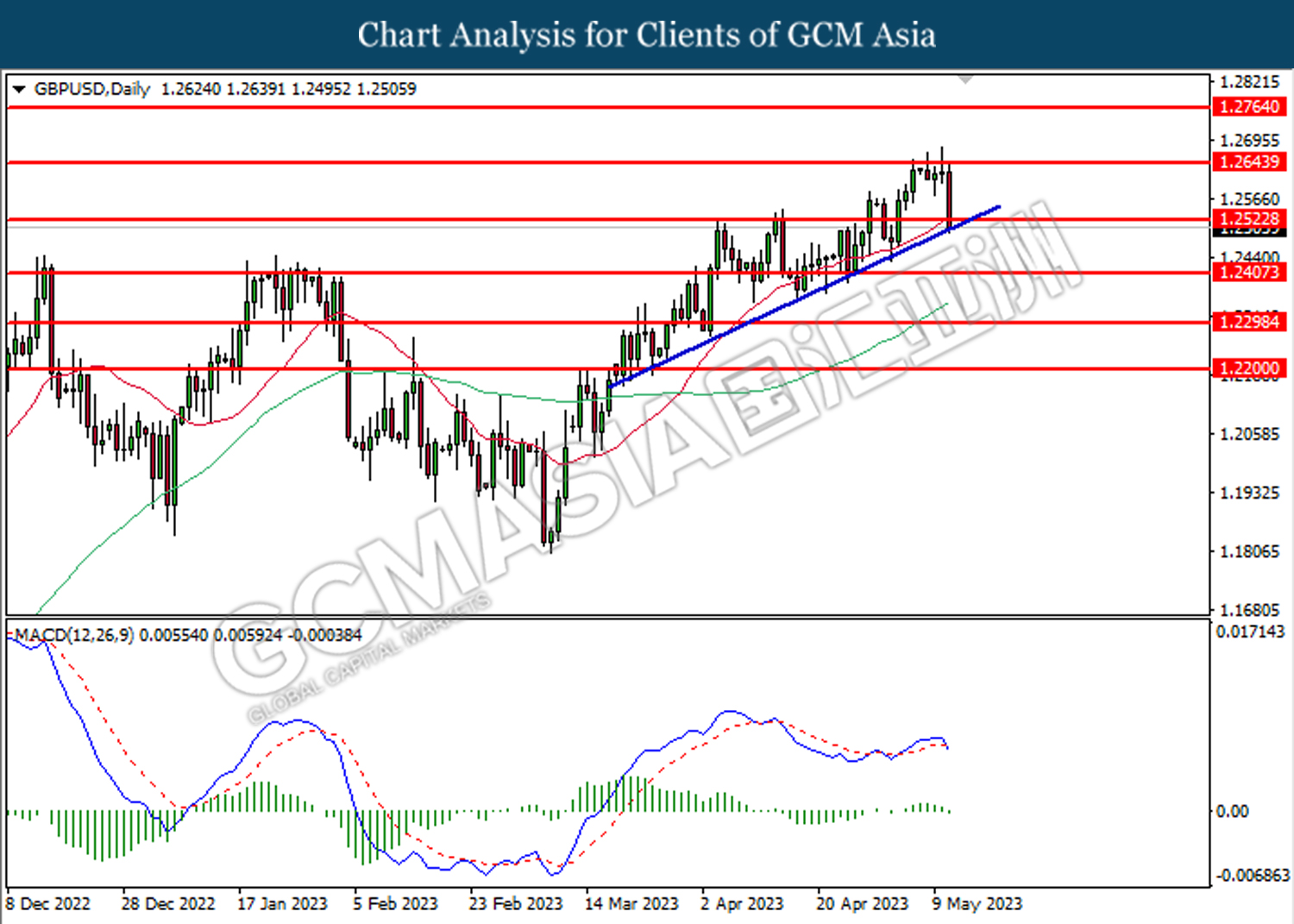

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

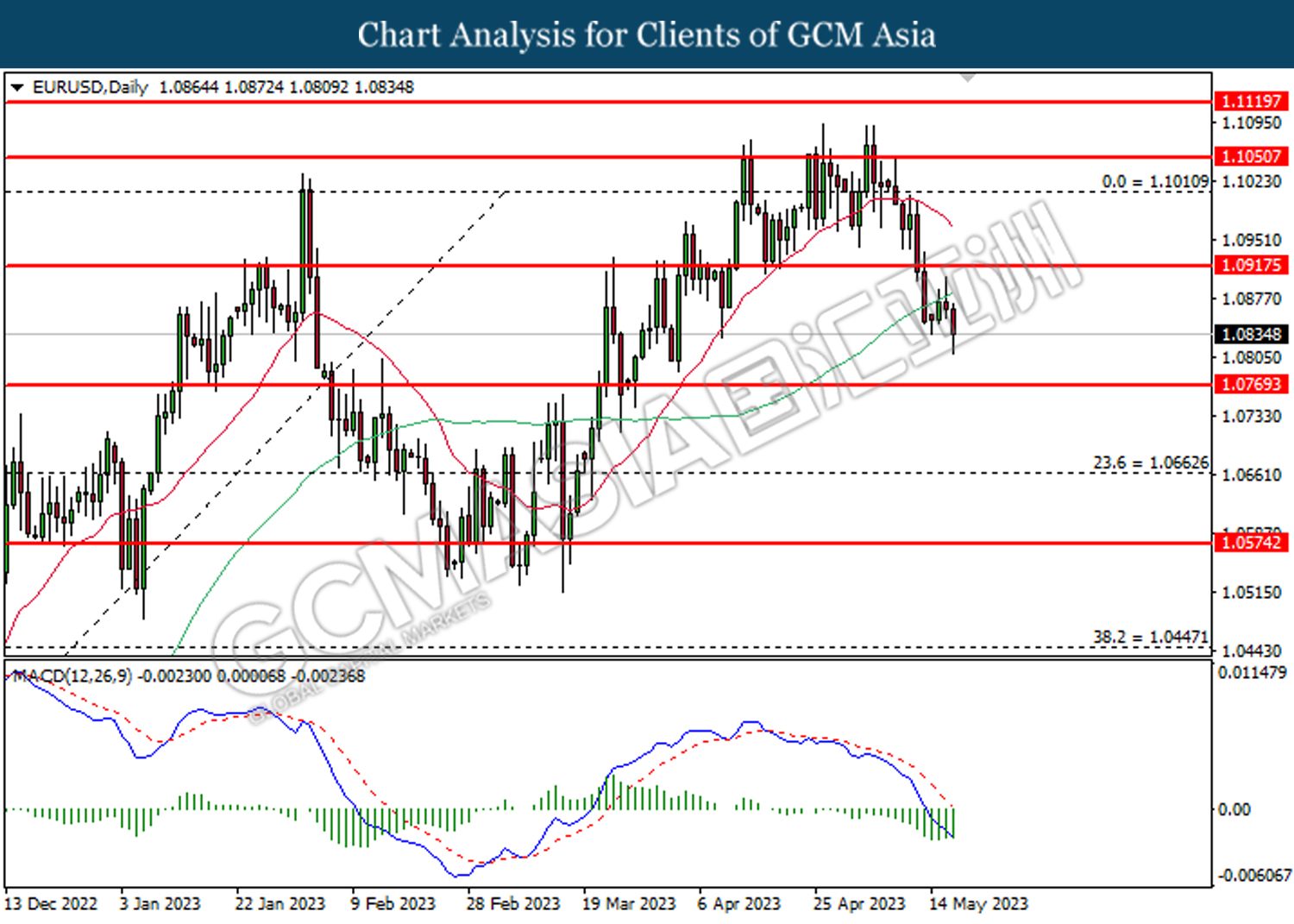

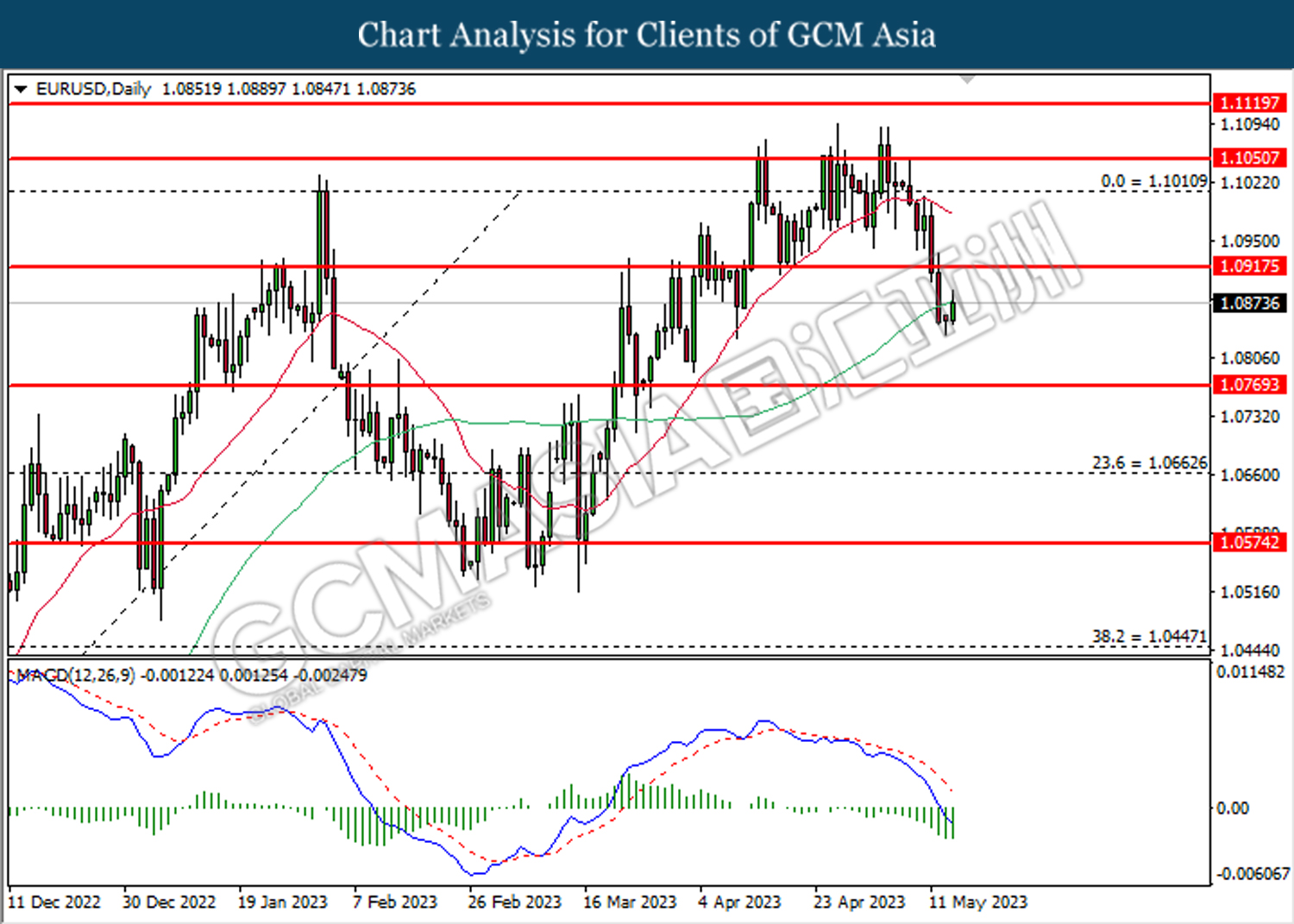

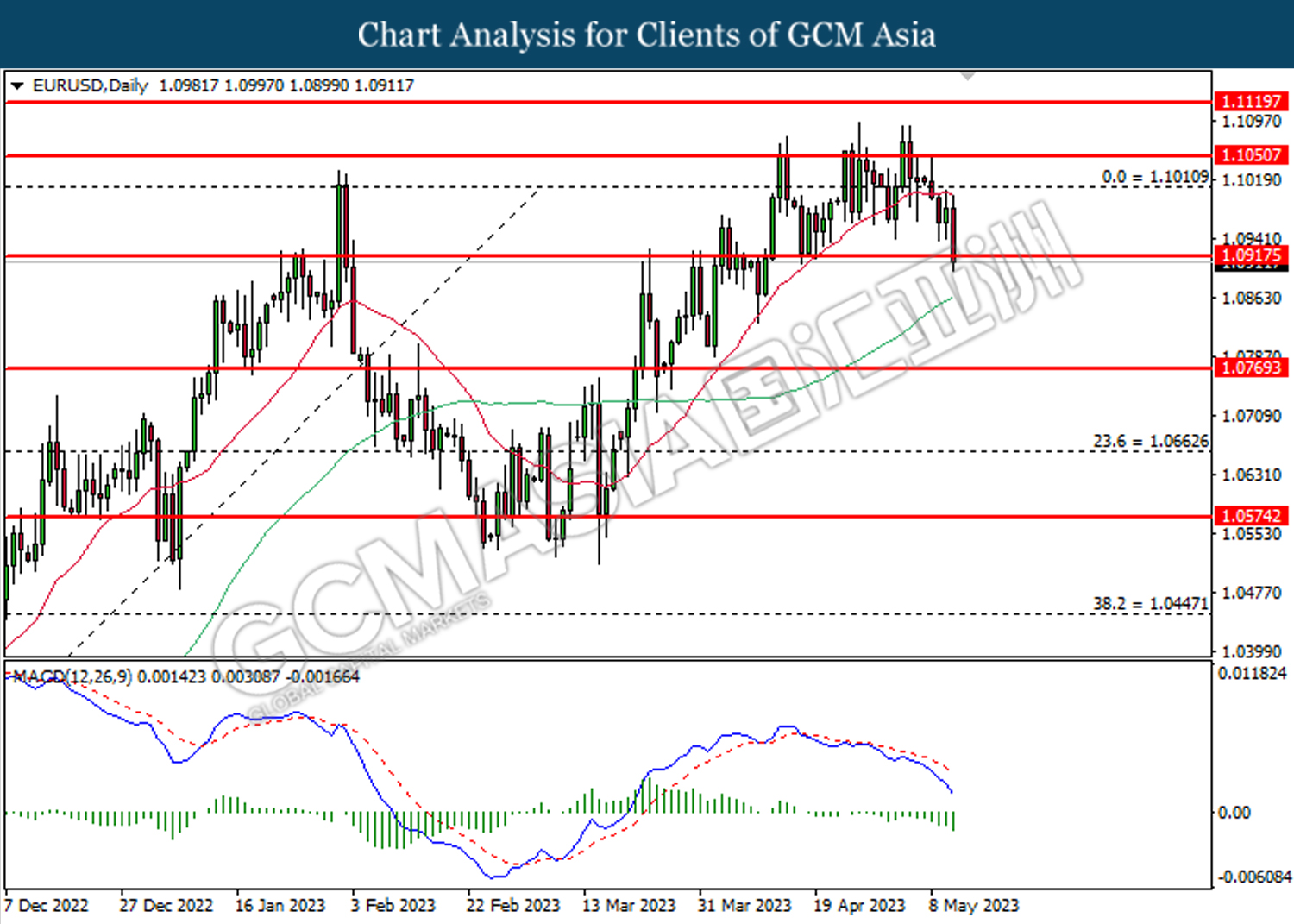

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

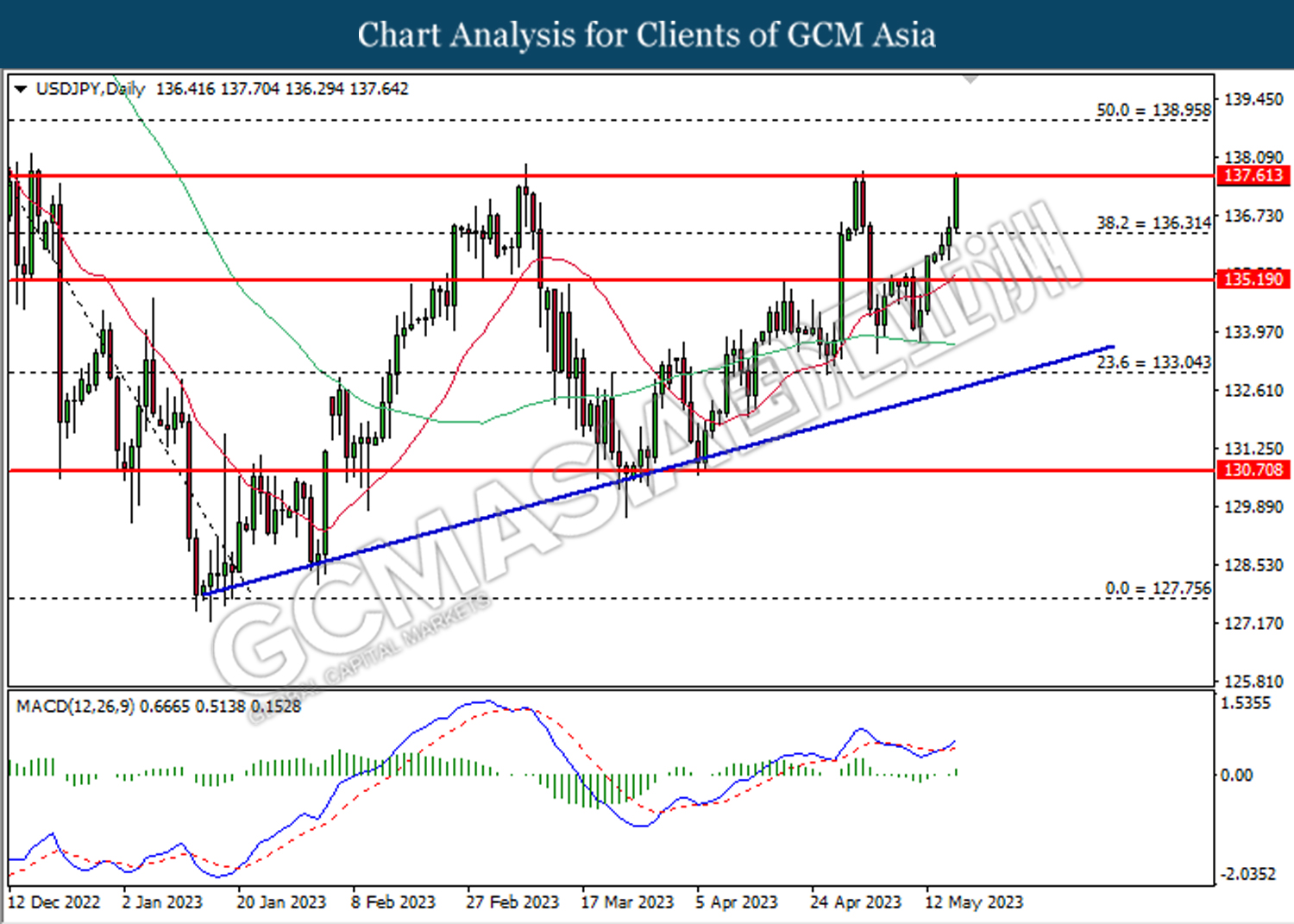

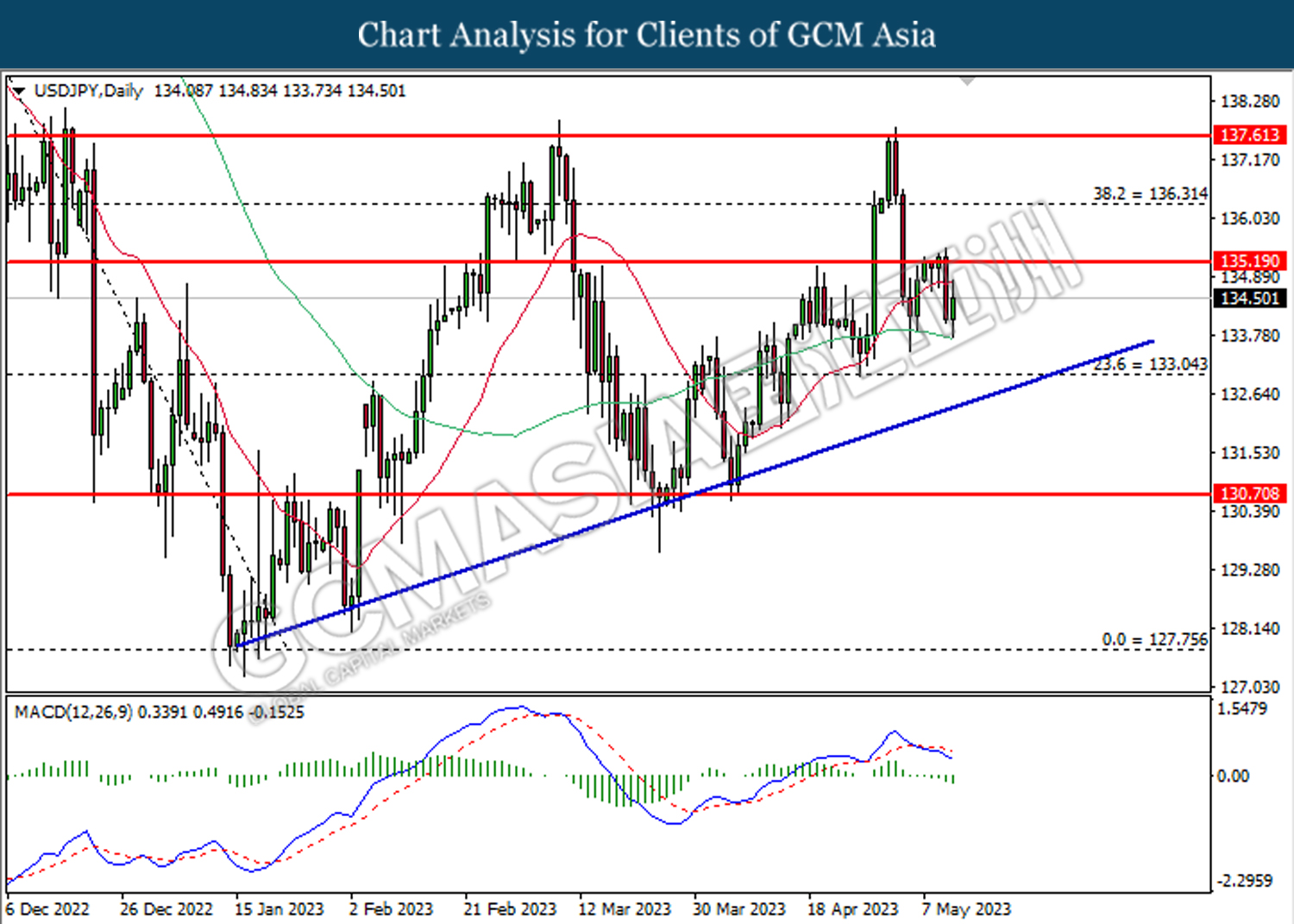

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 137.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 137.60, 138.95

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.9000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

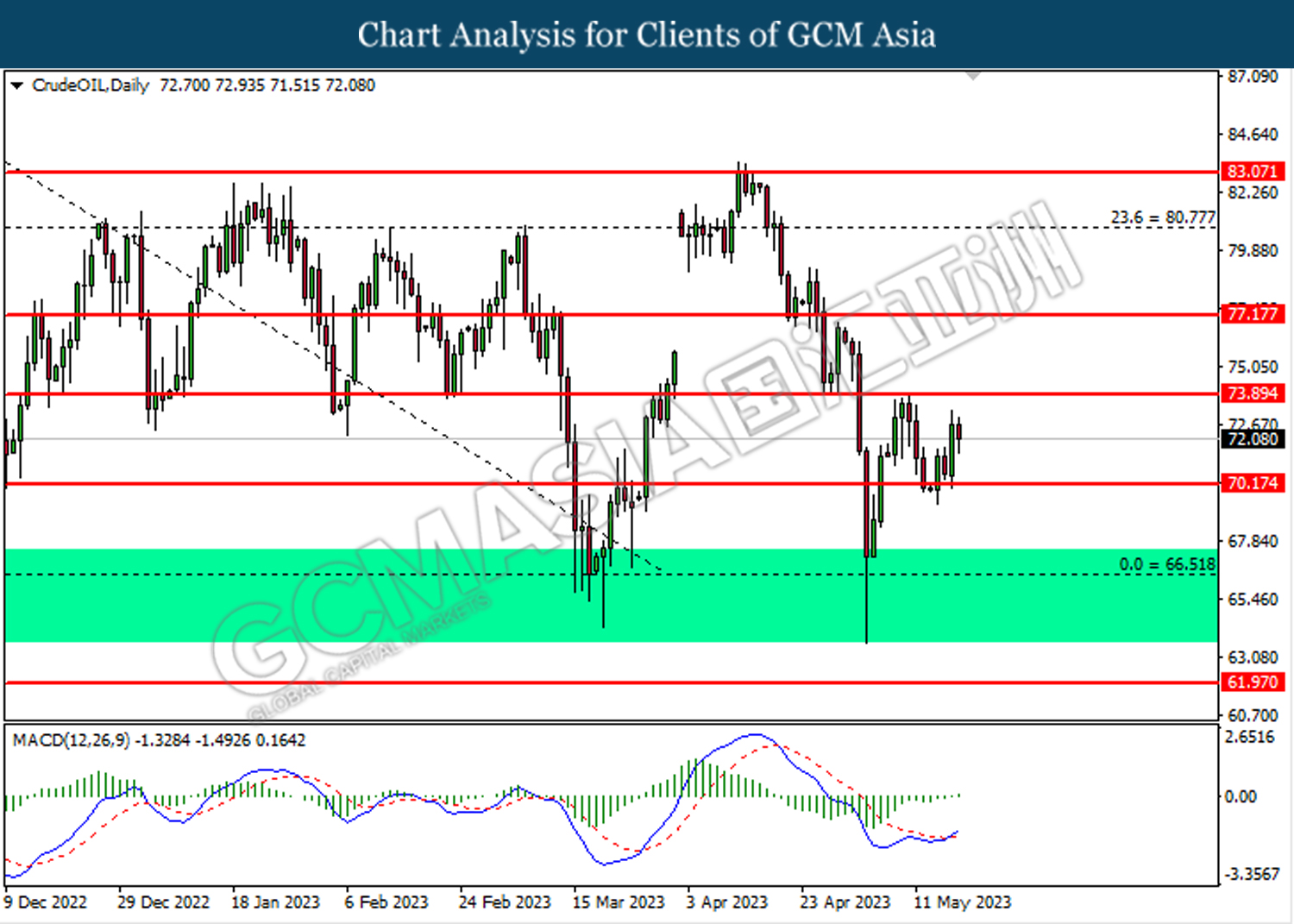

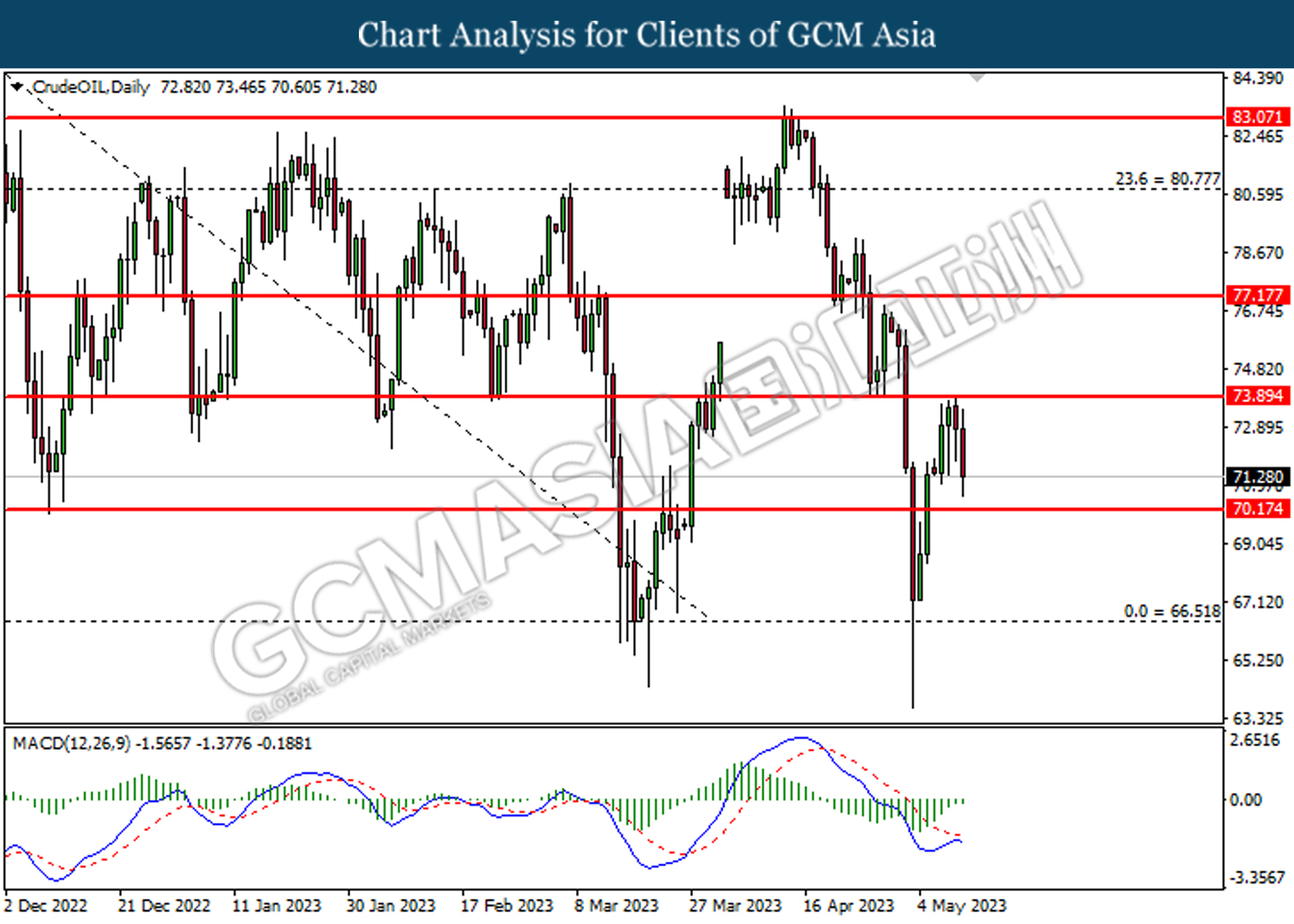

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

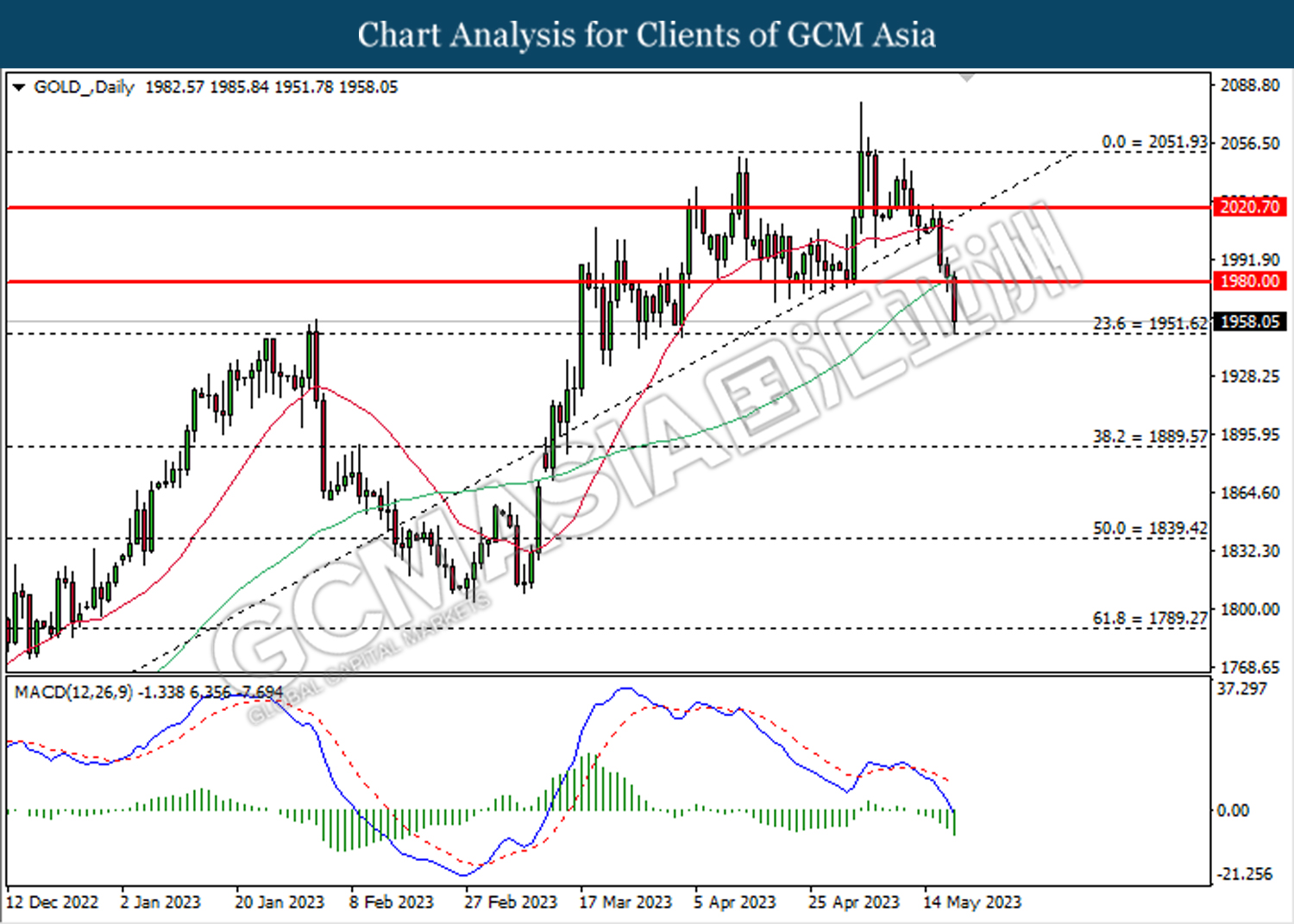

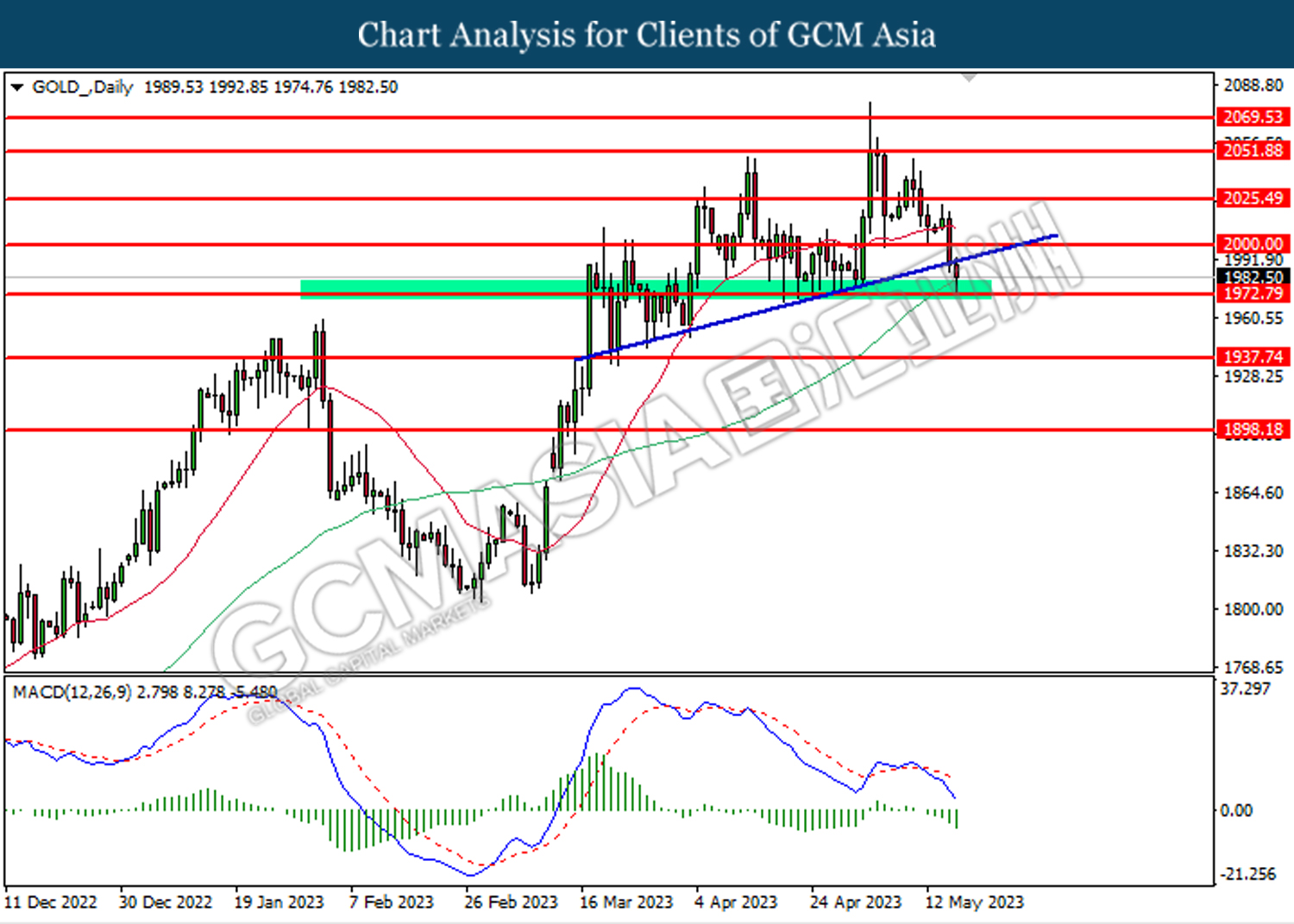

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

180523 Afternoon Session Analysis

18 May 2023 Afternoon Session Analysis

The Aussie slipped on weakened labour conditions.

The Aussie dollar, which was traded against the greenback, extended its losses after the weak labor conditions in Australia. The labor data unexpectedly showed a contraction in April, while the unemployment data rose amid a cooling in economic activities. The number of employment changes was recorded at -4.3k data from the Australia Bureau of Statistics (ABS). This data surprised the market as the market expected the reading to fall to 25k from 61.1k in the previous month. The unemployment reading increased to 3.7% from 3.5% higher than prior readings. A fewer number of people worked on account of the Easter holidays, and it also indicates the Australian labor shortage is being met by people working longer hours, ABS said in the release. The data showed some weakening in the labor market following a post-Covid boon over the past year and it also reflects the high interest rate decision by the Reserve Bank of Australia. As a result, the weakened labor conditions suggested that RBA consider pausing its tightening moves. As of writing, the pair of AUD/USD, extended its losses by -0.24% to $0.6644.

In the commodities market, crude oil prices ticked down by -0.56% to $72.44 per barrel following a prior rebound after investors regain confidence in US debt ceiling talks. Besides, gold prices slipped by -0.14% to $81978.81 per troy ounce as the dollar index

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB President Lagarde Speaks

17:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 264K | 254K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (May) | -31.3 | -19.0 | – |

| 22:00 | USD – Existing Home Sales (Apr) | 4.44M | 4.30M | – |

Technical Analysis

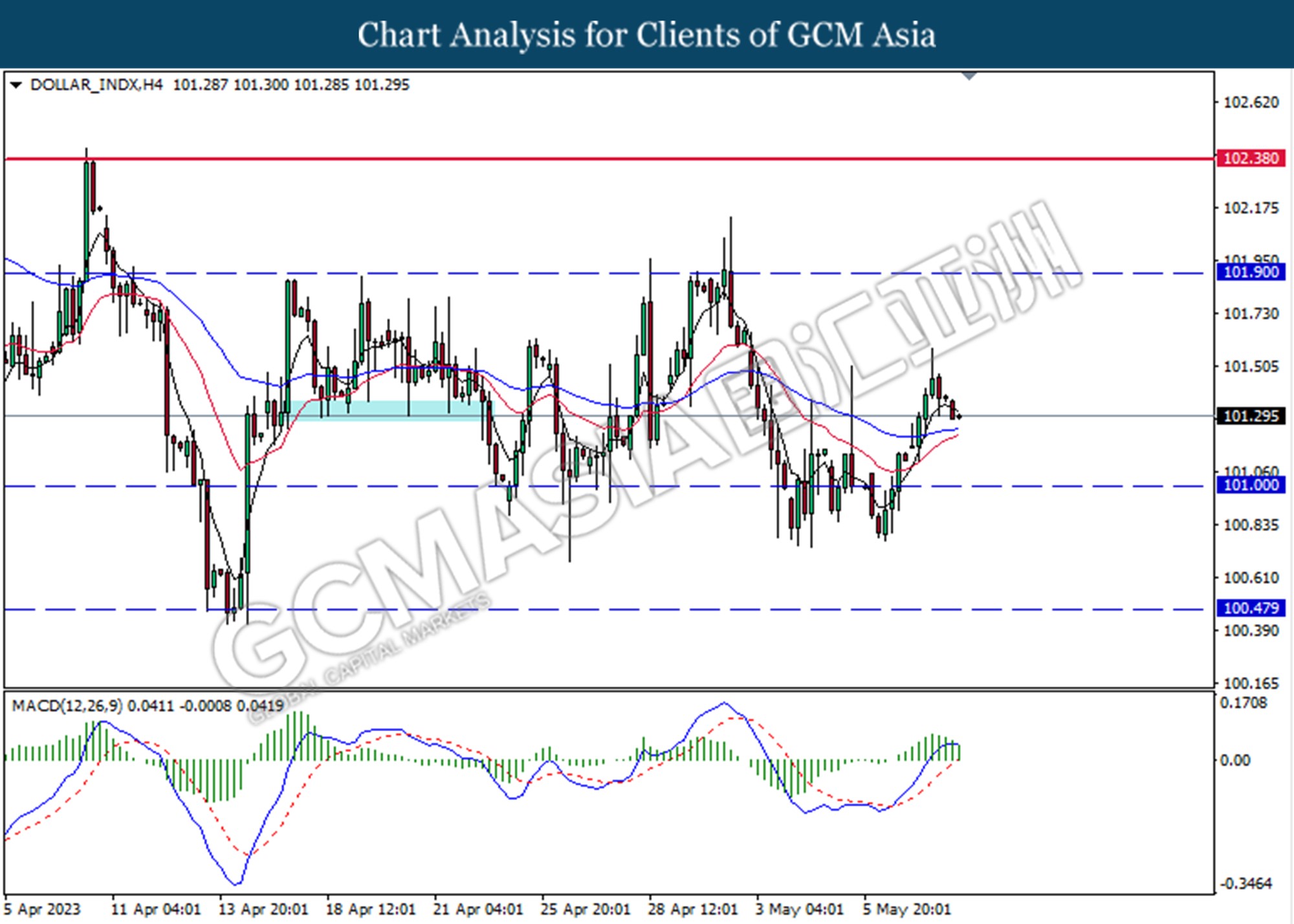

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the upward trend line.

Resistance level: 103.00, 103.75

Support level: 101.90, 100.80

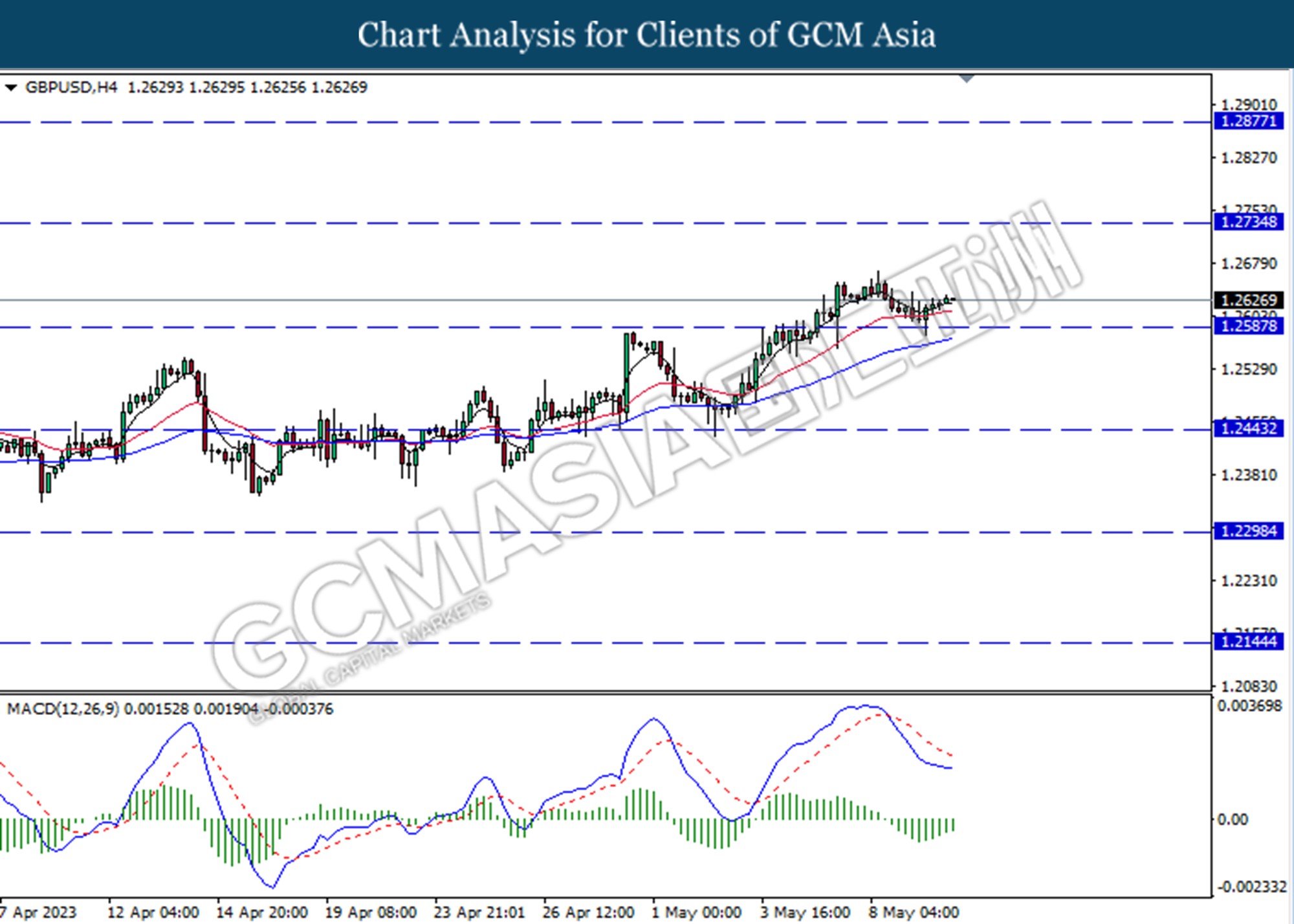

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

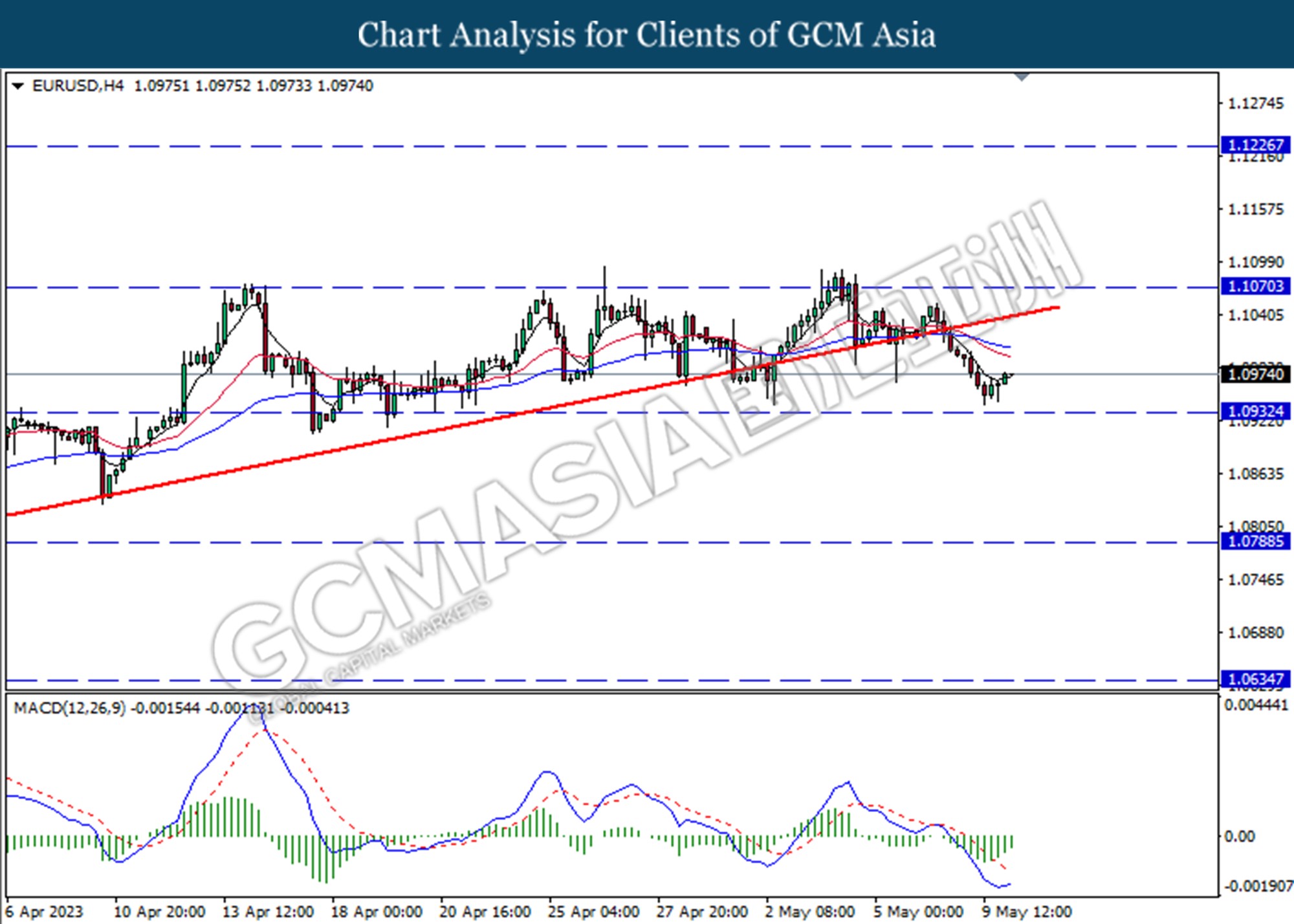

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.0935, 1.1070

Support level: 1.0790, 1.0635

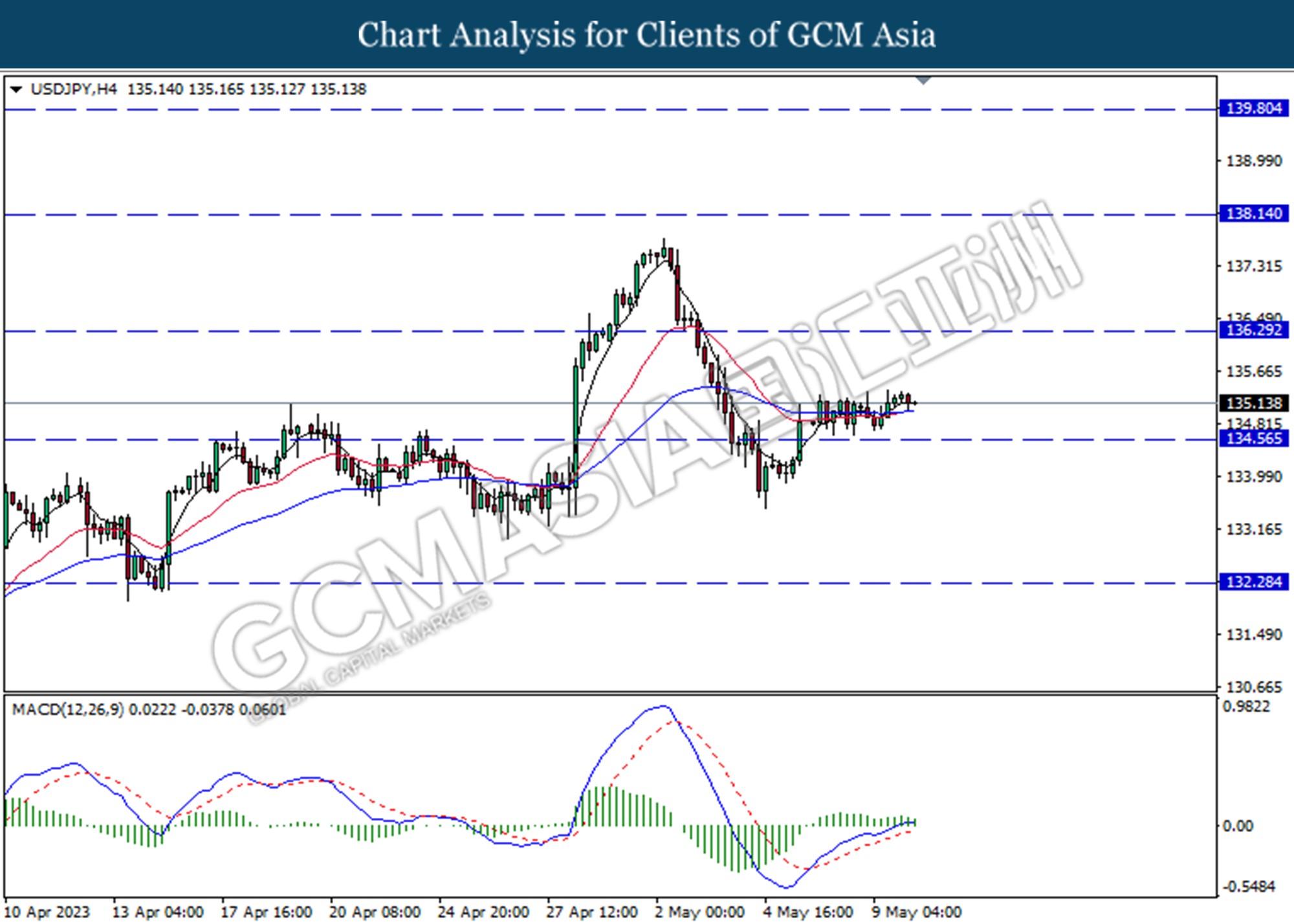

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 136.30.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher while currently testing for the resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3420, 1.3330

Support level: 1.3515, 1.3600

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.9005. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 70.65. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 73.20.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1985.50. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15

180523 Morning Session Analysis

18 May 2023 Morning Session Analysis

Greenback buoyed by debt ceiling optimism.

The dollar index, which was traded against a basket of six major currencies, hovered near the highest level in seven weeks as the recent progress in the debt ceiling talks boosted the sentiment in dollar market. Yesterday, before the US President Joe Biden prepared to travel to Japan for the G7 leader summit, he revealed that his meeting with the congressional members had been “civil and respectful” as both parties noticed the consequences of no deal on raising the debt ceiling. Biden also said that he is confident that they will eventually seal a deal and US will not default before 1st of June. With such a backdrop, the investors regained their confidence that a debt ceiling crisis would see a resolution sooner or later. However, a deal is unforeseeable within the next few days as Joe Biden will only be back in Washington on Sunday. Prior to that, Biden has shortened his Asia trip where he has canceled to visit Papua New Guinea and Australia, in order to continue the debt ceiling talk. As of writing, the dollar index rose 0.28% to 102.85.

In the commodities market, crude oil prices edged up by 3.12% to $72.80 per barrel amid the optimism on U.S. debt ceiling negotiations boosted the prospect of oil market. Besides, gold prices ticked down by -0.09% to $1983.40 per troy ounce as the optimism on debt ceiling talk outweighed the market worries over banking crisis.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB President Lagarde Speaks

17:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 264K | 254K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (May) | -31.3 | -19.0 | – |

| 22:00 | USD – Existing Home Sales (Apr) | 4.44M | 4.30M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 137.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 137.60, 138.95

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3485. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3395.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1972.80. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2000.00, 2025.50

Support level: 1972.80, 1937.75

170523 Afternoon Session Analysis

17 May 2023 Afternoon Session Analysis

The Pound extended losses after weakening economic conditions.

The Pound Sterling, which was traded against the greenback, extended its losses after the weak economic conditions looms over the markets. In March, the employment average earning plus bonus showed 5.8% steadily at the same level as market expectation and prior readings. However, other key labor force data for March were softer, according to the Office for National Statistics (ONS). The 3 months employment change data showed an increase to 182 thousand while economists expect this reading to slip to 160 thousand from the prior reading of 169 thousand. Nonetheless, Britain’s unemployment rate unexpectedly rose to 3.9% as more labor returned to the jobs market. Employment and non-unemployment both rose again in the first 3 months of 2024, and the number of neither working nor looking for work continues to fall, despite the number of unemployed due to long-term sickness rising to new records, the director of economics in ONS said. Weak labor conditions were further supported by claims in March, which surged by 46,700, compared with forecasts for a rise of 31,200. As a result, the latest labor market suggested a less hawkish monetary position as labor market conditions deteriorates. It also increases the odds that the Bank of England (BoE) debate its further interest rate decision. As of writing, the GBP/USD traded down by -0.01% to $1.2486.

In the commodities market, crude oil prices appreciated by 0.08% to $70.92 per barrel as investors remained cautious after API crude oil inventory showed surplus readings. Besides, gold prices ticked up by 0.14% to $1991.60 per troy ounce following the prior debt ceiling talks remains uncertain.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:50 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 20:30 | USD – Building Permits (Apr) | 1.430M | 1.430M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.951M | -0.917M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 103.00.

Resistance level: 103.00, 103.75

Support level: 101.90, 101.00

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bearish momentum suggests the pair extended its losses toward the support level at 1.2445.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher following the prior breaks above the previous resistance level at 136.30. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below from the previous support level at 0.6685. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo a technical correction in the short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergo a technical correction in the short term.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 70.65. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergo a technical correction in the short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1985.50. However, MACD which illustrated bearish momentum the commodity undergoes a technical correction in the short term.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

170523 Morning Session Analysis

17 May 2023 Morning Session Analysis

US dollar surged while the debt ceiling in spotlight.

The dollar index, which was traded against a basket of six major currencies, regained its luster after a technical correction in the previous trading session amid constructive progress in the recent talk and both parties showed their strong-willingness on sealing a deal in the talks. According to the a communique, US President Joe Biden said the hour-long meeting with the congressional members on Tuesday was “good and productive” and that he was optimistic about the prospects for a deal. Besides, Mr McCarthy, who has been pessimistic throughout the negotiations, told reporters he believed a deal was possible by the end of this week. In order to avoid the US entering a calamitous default on its $31.4 trillion, Biden has canceled a trip to Australia and Papua New Guinea and will return to Washington after the end of G7 summit in Japan to focus on the debt ceiling. However, it is noteworthy to highlight that there is no official deal on raising the debt limit has been sealed at this point in time. The republicans are still demanding a spending cuts, while Joe Biden repeatedly said that a potential debt default and budget spending should be separate. As of writing, the dollar index rose 0.17% to 102.60.

In the commodities market, crude oil prices edged down by -0.55% to $70.95 per barrel amid a weaker demand from China and US oil inventory increased. Besides, gold prices ticked up by 0.05% to $1990.10 per troy ounce following a tremendous sell-off yesterday’s night amid the rise in US treasury yield.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:50 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 20:30 | USD – Building Permits (Apr) | 1.430M | 1.430M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.951M | -0.917M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

AUDUSD, Daily: AUDUSD was traded lower while currently retesting the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 2000.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80

160523 Afternoon Session Analysis

16 May 2023 Afternoon Session Analysis

EUR lifted up after the economic outlook improved. consumer

The Euro which was traded against the greenback, was lifted yesterday after the European Commission delivered an optimistic spring 2023 economic forecast. The economic outlook for 2023 and 2024 was revised up to 1.0% and 1.7%, respectively, from 0.8% and 1.0%. The main factor attributed to the revised is the lower energy price allows governments to phrase out energy support measures. Falling in energy prices drove further government budget deficit reductions to 3.1% and 2.4% in 2023 and 2024 in accordingly. The headline inflations will further be cooling amid a sharp deceleration of energy prices. Moreover, the labor market remains resilient against economic slowdown since the EU unemployment rate hit a record low of 6.0% in March 2023. Wage growth has picked up since early 2020 but estimation of the upcoming unemployment rate will remain just above 6%. However, the expansion of the economy showed in slowing pace after the EU industrial production in March presented in negative -4.1% reading, lower than the previous reading and market estimations which is 1.5% and -2.5% respectively. The output of capital goods such as construction and equipment fell 15.4% in the month, while Irish output plunged 26.3% for the month, Eurostat said on Monday. Meanwhile, investors are await for Christine Lagarde, European Central Bank (ECB) Governor’s speech tonight to get a clue from it. As of writing, the EUR/USD edged up by 0.08% to 1.0883.

In the commodities market, crude oil prices are up by 0.48% to $71.45 per barrel amid the US Department of Energy’s plan to refill its Strategic Petroleum Reserve (SPR). Besides, gold prices gained by 0.01% to $2016.69 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (May) | 4.1 | -5.3 | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | -0.4% | 0.4% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | -0.6% | 0.8% | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 0.6% | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level at 101.90.

Resistance level: 103.00, 104.45

Support level: 101.90, 101.00

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded lower following the prior retracement from resistance level at 136.30. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 136.30.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6685. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following the prior break below from the previous support level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following the prior break above from the previous resistance level at 70.65. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 2030.10, 2049.30

Support level: 2009.10, 1985.50

160523 Morning Session Analysis

16 May 2023 Morning Session Analysis

US dollar tumbled as debt ceiling issue remained unsolved.

The dollar index, which was traded against a basket of six major currencies, reverted its previous gains yesterday as the market participants are waiting for a clearer signals from the US on how they are going to avoid a first ever default before 1st June. At this point in time, the Joe Biden has scheduled a meeting to talk with the congressional leaders on tomorrow morning before he leaves for G7 meeting in Japan. Prior to that, the talk on last Sunday between the two sides have been “constructive, according to the Deputy Treasury Secretary Wally Adeyemo. The White House has not ruled out imposing annual spending caps, whereby the Republicans has been emphasizing that the annual spending caps are necessary for them to agree on raising the nation’s $31.4 trillion debt limit. However, the two parties do not appear close to a deal and it is seemingly that the stalemate would remain for a longer time as both parties maintain their own provincial hardline stance. Besides, the US Treasury secretary has repeatedly called on Congress to agree to raise the US $31.4tril federal borrowing limit to avoid the “economic and financial catastrophe” that would ensue if the US defaulted on its debt. As of writing, the dollar index dropped -0.25% to 102.40.

In the commodities market, crude oil prices edged up by 0.64% to $70.55 per barrel amid wildfires in Canada boosted the prospect of tightening supply. Besides, gold prices ticked up by 0.02% to $2016.10 per troy ounce as the dollar retreated from its recent high level.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Mar) | 5.9% | 5.8% | – |

| 14:00 | GBP – Claimant Count Change (Apr) | 28.2K | 31.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (May) | 4.1 | -5.3 | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | -0.4% | 0.4% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | -0.6% | 0.8% | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 0.6% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior above the previous resistance level at 135.20. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 136.30.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated diminishing bearish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 2000.00.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80

150523 Afternoon Session Analysis

15 May 2023 Afternoon Session Analysis

The pound extended losses after weak economic conditions.

The pound which traded against the greenback extended its losses after the crucial economic data was released last Friday. The UK Q1 GDP was expected to shrink to 0.4% of growth, but the actual result marked at 0.3%, slipped more than market expectations. The growth of the service sectors was contributed by information and communication 1.2% and administrative and support services 1.3%. While the consumer spending sector showed no increase after the household remains in a cautious mood as incomes continue to squeeze by high inflation. Nonetheless, the Office for National Statistics (ONS) said that the UK economy suffered from the awful weather during the month which caused household spending reduced. The reason for the contraction came from the 6th Wettest March since 1836 caused the consumers to stay indoors and retail sales suffered. Besides that, both industrial and manufacturing production continues to present in contraction moves, which are remarked at -0.1% and 0.1% respectively. Both readings slipped from the 0.7% in the prior month. With such backdrops, the pound against the greenback extended its losses toward the 1.2460 level. As of writing, the GBPUSD was increased by 0.08% to $1.2466.

In the commodities market, crude oil prices were traded lower by -0.34% to $69.80 per barrel amid economic concern over a potential US recession affecting the oil demand. Besides, gold prices edged up by 0.26% to $2016.04 per troy ounce following the prior weakening in the US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.90.

Tahap rintangan: 101.90, 104.50

Tahap sokonagan: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Tahap rintangan: 1.2590, 1.2735

Tahap sokonagan: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Tahap rintangan: 1.0930, 1.1070

Tahap sokonagan: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 136.30. MACD which illustrated increasing bullish momentum suggests the pair extended its gains if successfully break above the resistance level.

Tahap rintangan: 136.30, 138.15

Tahap sokonagan: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6685. MACD which illustrated increasing diminishing bearish momentum suggests the pair extended its gains if successfully break above the resistance level.

Tahap rintangan: 0.6685, 0.6775

Tahap sokonagan: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the support level at 0.6195. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Tahap rintangan: 0.6265, 0.6320

Tahap sokonagan: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3515.

Tahap rintangan: 1.3600, 1.3685

Tahap sokonagan: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.8925.

Tahap rintangan: 0.9005, 0.9090

Tahap sokonagan: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded lower following a prior break below the previous support level at 70.65. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical correction in the short term.

Tahap rintangan: 70.65, 73.20

Tahap sokonagan: 67.00, 63.85

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 2009.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Tahap rintangan: 2030.10, 2049.530

Tahap sokonagan: 2009.10, 1985.50

150523 Morning Session Analysis

15 May 2023 Morning Session Analysis

Greenback surged despite disappointing economic data.

The dollar index, which was traded against a basket of six major currencies, extended its rallies last Friday as the market participants were optimistic toward the talks of a debt ceiling between Joe Biden and the Congressional members. Early today, a top US economic official said on Sunday that the talk between congressional staff and the White House has been “constructive” as the US debt ceiling deadline approaches on June 1. Prior to that, the talk was postponed once as staff-level talks continued. Besides, President Joe Biden also said that he looks forward to getting together with the leaders to talk about how they continue to make progress. Despite no agreement or deal being sealed at this point in time, the ‘constructive’ progress in raising the debt limit has cheered the market sentiment. On the economic front, the Michigan Consumer Sentiment data, which represents consumer confidence and optimism in the US, came in at 57.7, much lower than the consensus forecast of 63.0. The consumer sentiment tumbled significantly as market worries escalated in the month of May amid ongoing banking crisis risk and the possibility of lawmakers failing to resolve the debt ceiling heightened. As of writing, the dollar index edged up 0.02% to 102.70.

In the commodities market, crude oil prices dropped by -0.02% to $70.05 per barrel after the market corrected on recession fears and a stronger US dollar. Besides, gold prices ticked down by -0.01% to $2010.60 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior above the previous resistance level at 135.20. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 136.30.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

AUDUSD, Daily: AUDUSD was traded lower following prior below the previous support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3565. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level at 1.3565.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower while currently testing near the support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 2000.00.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80

120523 Afternoon Session Analysis

12 May 2023 Afternoon Session Analysis

The Pound fell aftermath Bank of England (BoE) hikes rate

The pound sterling which traded against the greenback lost its ground after the Bank of England (BoE) raised the official cash rate by 25 basis points to 4.5%. Firstly, The Monetary Policy Committee (MPC) voted 7-2 in favor of a rate hike to curb high inflation. According to BoE monetary statement, one of the reasons for the high inflation rate is due to food price inflation as the prices are likely to fall back more slowly than expected. Investors anticipated the 25bps tightening move after CPI came in at 10.2% in March, and lowered their expectations for a Bank of England rate decision. However, the pound revised its losses from gains after Andrew Bailey, BoE Governor speak. Bailey said the past rate hike weighs more economy in coming quarters, as the effect of high-interest rate lagging filters into the economy. These comments prompted investors that the BoE will consider a more softened decision on the next interest rate decision. Besides, investors’ eyes are on upcoming economic data such as quarter GDP and manufacturing production conditions. The economists are expecting the UK economy to show contraction in quarter 1. As of writing, the GBP/USD traded up by 0.10% to $1.2521.

In the commodities market, crude oil prices were traded lower by -0.42% to $70.56 per barrel after disappointing economic data from China and concern over a potential US recession affecting the oil demand. Besides, gold prices shrank by -0.17% to $2011.62 per troy ounce following the prior strengthening in the US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 63.5 | 63.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the resistance level at 101.90. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.40, 101.90

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded lower following a prior break below from the previous support level at 12590. However, MACD which illustrated diminishing bearish momentum suggests the pair traded higher as a technical correction.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded lower following a prior break below from the previous support level at 1.0930. However, MACD which illustrated diminishing bearish momentum suggests the pair traded higher as a technical correction.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 134.55. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded lower following break below the previous support level at 0.6325. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6265.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3420. However, MACD which illustrated diminishing bullish momentum suggests the pair traded lower as a technical correction.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower while currently testing for the support level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses after it successfully break below the support level.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 70.65. MACD which illustrated diminishing bearish momentum suggests the pair extended its losses after it successfully break below the support level.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded lower while currently testing the support level at 2009.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its losses after it successfully breakout below the support level.

Resistance level: 2030.10, 2049.30

Support level: 2009.10, 1985.50

120523 Morning Session Analysis

12 May 2023 Morning Session Analysis

US dollar rallied amid market’s risk aversion heightened.

The dollar index, which was traded against a basket of six major currencies, managed to extend its gains yesterday as the market risk aversion spiked following the poor performance in the US stock market. The safe haven currency, dollar index, has gathered bullish momentum as the US stock market were under huge selling pressures from the downbeat quarter report from Disney and continued sell-off of shares, especially in the US banking sector. Yesterday, the investor worry over the regional banks exacerbated as a regulatory filing showed that the PacWest Bancorp deposits fell another 9.5% during the week of May 5. With the ongoing banking crisis and debt ceiling overhang, investors chose to run away from the riskier asset, such as US stock market. On the other side, the tamer US PPI data which came in at 0.2%, slightly lower than the forecast at 0.3%, failed to stop the strong rally in the US dollar market. Besides, the US Bureau of Labor Statistics reported that the number of American who filed for unemployment claims in the past week was 264K, hitting the 1.5 year high while also pointing to a slowing labor market condition in the US. As of writing, the dollar index rose 0.58% to 102.05.

In the commodities market, crude oil prices were traded lower by –0.04% to $71.40 per barrel after the OPEC hold its global oil demand forecast steady as the recovery of demand from China may be offset by the US banking crisis and debt ceiling issue. Besides, gold prices ticked down by -0.03% to $2015.60 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q1) | 0.6% | 0.2% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Mar) | 0.0% | -0.1% | – |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 63.5 | 63.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2525. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2525.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level at 1.3485.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 2025.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 2025.50.

Resistance level: 2051.90, 2069.55

Support level: 2025.50, 2000.00

110523 Afternoon Session Analysis

11 May 2023 Afternoon Session Analysis

The pound muted ahead of the BoE interest rate decision.

The Pound Sterling, which was traded against the greenback, continued to be muted during Asian trading ahead of the Bank of England (BoE) interest rate decision. As of now, the markets are largely priced in that the BoE will hike the interest rate by 25 basis points A 98% chance of a 25-basis point rate hike from the BoE will further boost confidence in the decision, according to Refinitiv data. The Bank of England’s more tightened moves to come were largely due to the still-high March consumer price index (CPI). The previous data expected the CPI to fall to 9.8%, lower than the previous value of 10.4%, but the actual result was slightly higher than market expectations of 10.1%. Apart from this, the recent unemployment data achieved 3.8% showed the labor market reflects some softer conditions, despite its close to historical lows. The recent unemployment rate unexpectedly rose to 3.8% from 3.7%, the Office for Nations Statistics (ONS) data showed. With that, it increases the potential dilemma for the BoE to consider 50 basis points in upcoming interest rate decisions. As of writing, the GBP/USD shrunk by -0.02% to $1.2621.

In commodity markets, crude oil rose 0.73% to $73.09 a barrel as the dollar weakened, but gains were offset by Chinese CPI data. Elsewhere, gold edged up 0.09% to $2,032.20 a troy ounce as the market digested mixed US CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Interest Rate Decision (May)

19:00 GBP BoE MPC Meeting Minutes

19:00 CrudeOIl OPEC Monthly Report

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 242K | 245K | – |

| 20:30 | USD – PPI (MoM) (Apr) | -0.5% | 0.3% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.00.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2735, 1.2880

Support level: 1.2590, 1.2445

EURUSD, H4: EURUSD was traded higher following the prior rebound from the support level at 1.0930. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following the prior break below from the previous support level at 134.55. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6775. MACD which illustrated bullish momentum suggests the pair extended it gains if successfully break above the resistance level.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6325. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6400.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

USDCAD, H4: USDCAD was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended it gains toward the resistance level at 1.3420

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower following the prior retracement from the resistance level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 73.20. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following the prior breakout above the previous resistance level at 2030.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10

110523 Morning Session Analysis

11 May 2023 Morning Session Analysis

US dollar dived as inflation eased further.

The dollar index, which was traded against a basket of six major currencies, reversed its previous trading session gains as yesterday’s downbeat data wiped off the bullish sentiment in the dollar market. According to the US Bureau of Labor Statistics, the Consumer Price Index (CPI), the best and long-awaited inflation-gauge data, posted a reading of 4.9% for the month of April, slightly lower than both the consensus forecast and previous reading at 5.0%. The further drop in CPI data indicated that the rate hikes plan which has been implementing since more than a year ago is working well to curb the stubbornly high inflation in the US. The Federal Reserve (Fed) has adjusted the interest rates consecutively for 10 times, bringing the interest rate to their highest level in nearly 16 years. Despite, the inflation figure of 4.9% is still well-above the Fed’s long term target level at 2.0%. With that, the investors are now facing a fork in the road as the inflation report did not provide a clear signal if the Fed would really stop its rate hike plan in the next meeting. Therefore, the investors are now awaiting for more economic events, data and Fed members’ speak to determine the future path of monetary policy in the US. As of writing, the dollar index ticked down -0.15% to 101.45.

In the commodities market, crude oil prices were traded lower by -1.33% to $72.60 per barrel as the still-high inflation figure in the US pointed to a further rate hike, which dampened the prospect of oil market. Besides, gold prices ticked up by 0.05% to $2031.20 per troy ounce as the CPI eased more than expectation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Interest Rate Decision (May)

19:00 GBP BoE MPC Meeting Minutes

19:00 CrudeOIl OPEC Monthly Report

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 242K | 245K | – |

| 20:30 | USD – PPI (MoM) (Apr) | -0.5% | 0.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 2025.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 2051.90.

Resistance level: 2051.90, 2069.55

Support level: 2025.50, 2000.00

100523 Afternoon Session Analysis

10 May 2023 Afternoon Session Analysis

Yen shrank after pessimistic household spending.

The Japanese Yen, one of the most traded currencies shrank against the greenback after pessimistic housing spending was released. According to the Statistics Bureau of Japan, household spending in March declined to -1.9% from 1.6%, while the market expects on growth by 0.4%. Household spending with two or more people spent an average of 312,758 yen amid high food, energy, and other prices impacted by the Russian War, the Ministry of Internal Affairs and Communications said. Meanwhile, the real wages fell 2.9% in March from a year earlier, showing a twelfth straight month decline, affected by rising inflation. Major Japanese firms offer the biggest pay hikes amid inflation, but the negotiation has not filtered into higher wage growth. The current situation could prompt for new Governor Ueda to normalize its monetary policy. Elsewhere, investors are eyeing the upcoming summary of the Bank of Japan’s (BoJ) opinion for further cues. As of writing, the USDJPY traded down by -0.04% to $135.15.

In the commodities market, crude oil prices are down by -0.72% to $73.16 per barrel after US crude oil stockpiles rise unexpectedly. Besides, gold prices slipped by -0.15% to $2031.55 per troy ounce as investors awaits US inflations data for April.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (YoY) (Apr) | 5.0% | 5.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.280M | -1.100M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the support level at 1.2590. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2735, 1.2880

Support level: 1.2590, 1.2445

EURUSD, H4: EURUSD was traded higher following a prior rebound from the support level at 1.0930. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 134.55.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded lower following retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6325.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 73.20. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses after it successfully break below the support level.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity traded higher as a technical correction.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10