100523 Morning Session Analysis

10 May 2023 Morning Session Analysis

US dollar wobbled as debt ceiling talk had no progress.

The dollar index, which was traded against a basket of six major currencies, failed to extend its rally further amid head-butting between two major political parties on raising the debt ceiling despite default risk loomed. According to Reuters, President Joe Biden and Congressional lawmakers had a meeting early morning today, which aimed to solve the deadlock over raising the $31.4 trillion debt limit to avoid the US government from defaulting any of its existing debt. However, there were no progress in the talk between two parties, as none of them showed softening position. The House of Representatives Speaker Kevin McCarthy mentioned that there no any new movement, while complaining that “Biden didn’t agree to talks until time was running out”. The impasses of raising the debt ceiling are putting the US economy on the brink of collapse, whereby the risk of defaulting debt is heightening as time passes. As such, the dollar index received quite a fair bit of bearish momentum, pressing the value of the currency near the recent low level. Nonetheless, it is noteworthy to highlight that the two parties agreed to meet again on Friday for further talks. As of writing, the dollar index rose 0.27% to 101.65.

In the commodities market, crude oil prices edged up by 1.18% to $73.55 per barrel as the EIA Short Term Energy Outlook report showed a higher seasonal demand and lower-than-expected output going forward. Besides, gold prices ticked up by 0.94% to $2036.40 per troy ounce as the US government failed to raise its debt ceiling following a no-progress talk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (Apr) | 0.8% | 0.4% | – |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (YoY) (Apr) | 5.0% | 5.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.280M | -1.100M | – |

Technical Analysis

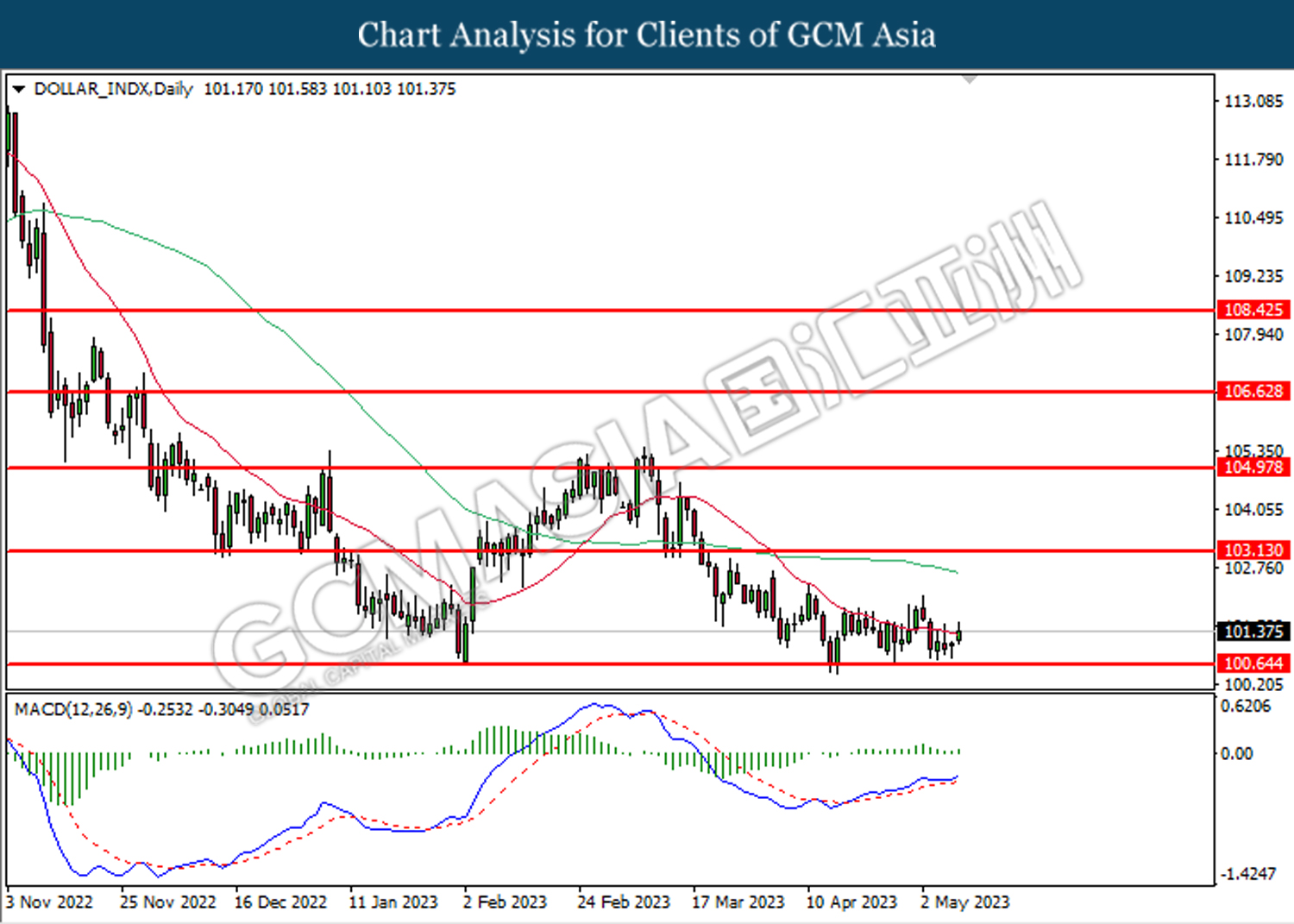

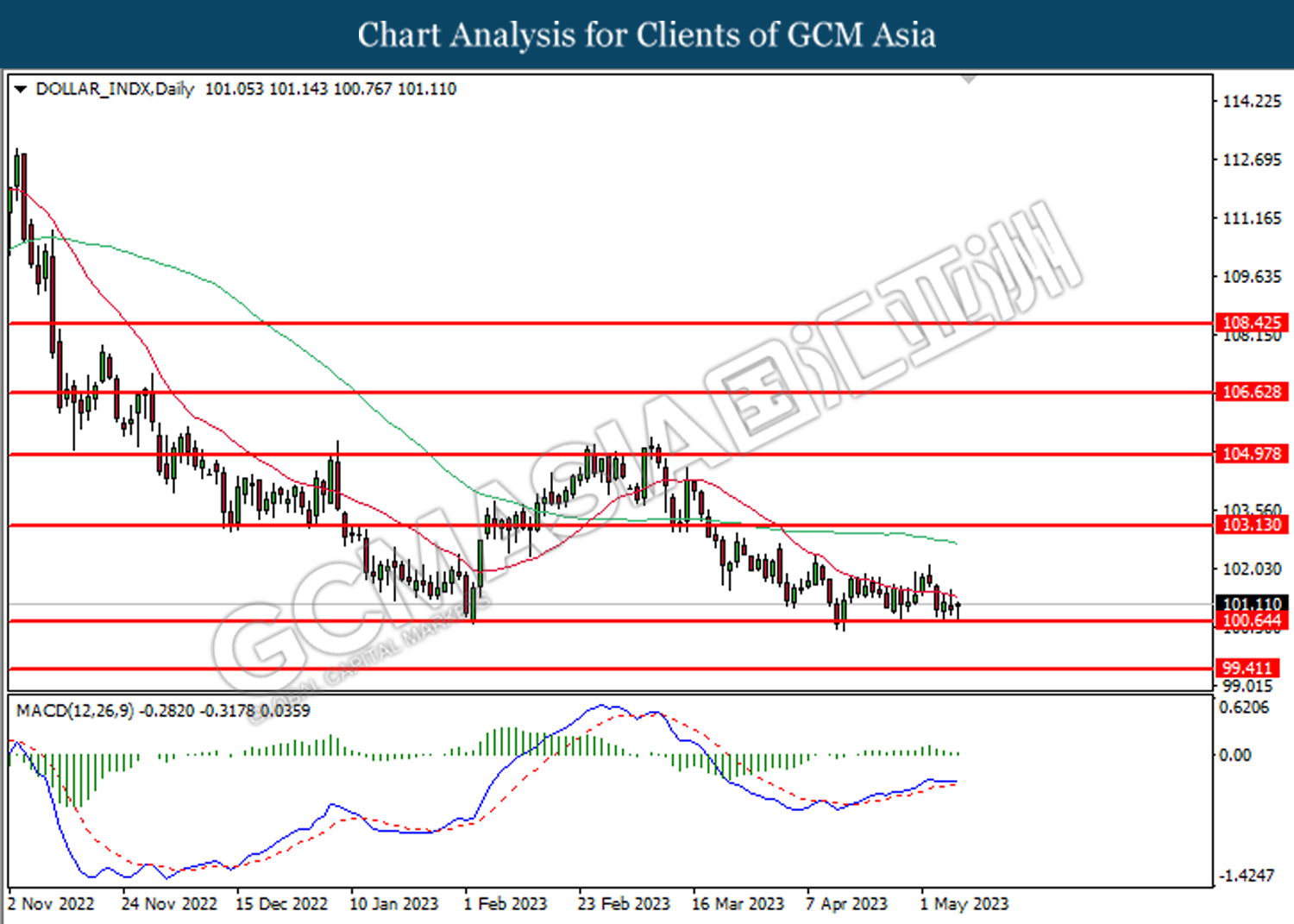

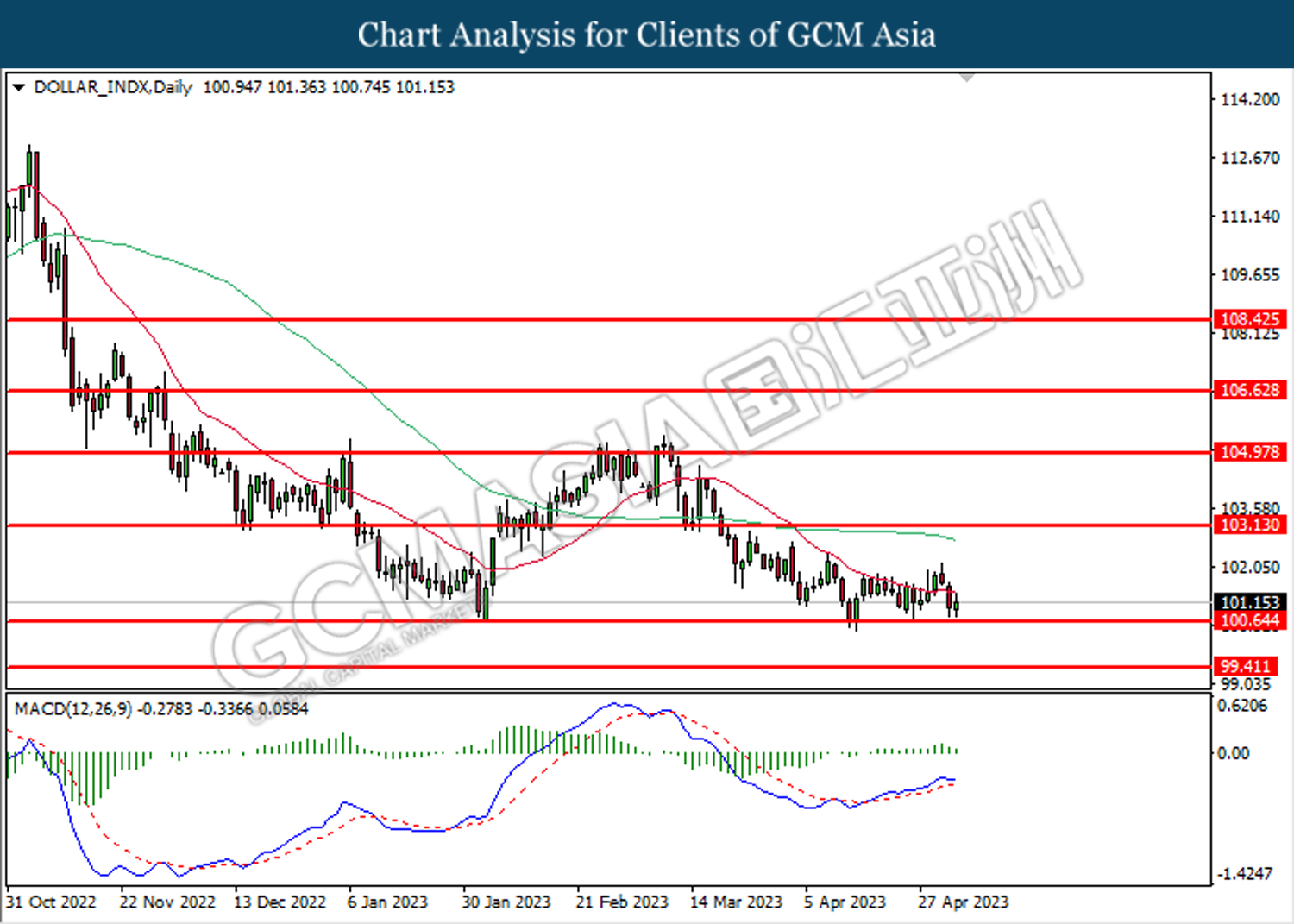

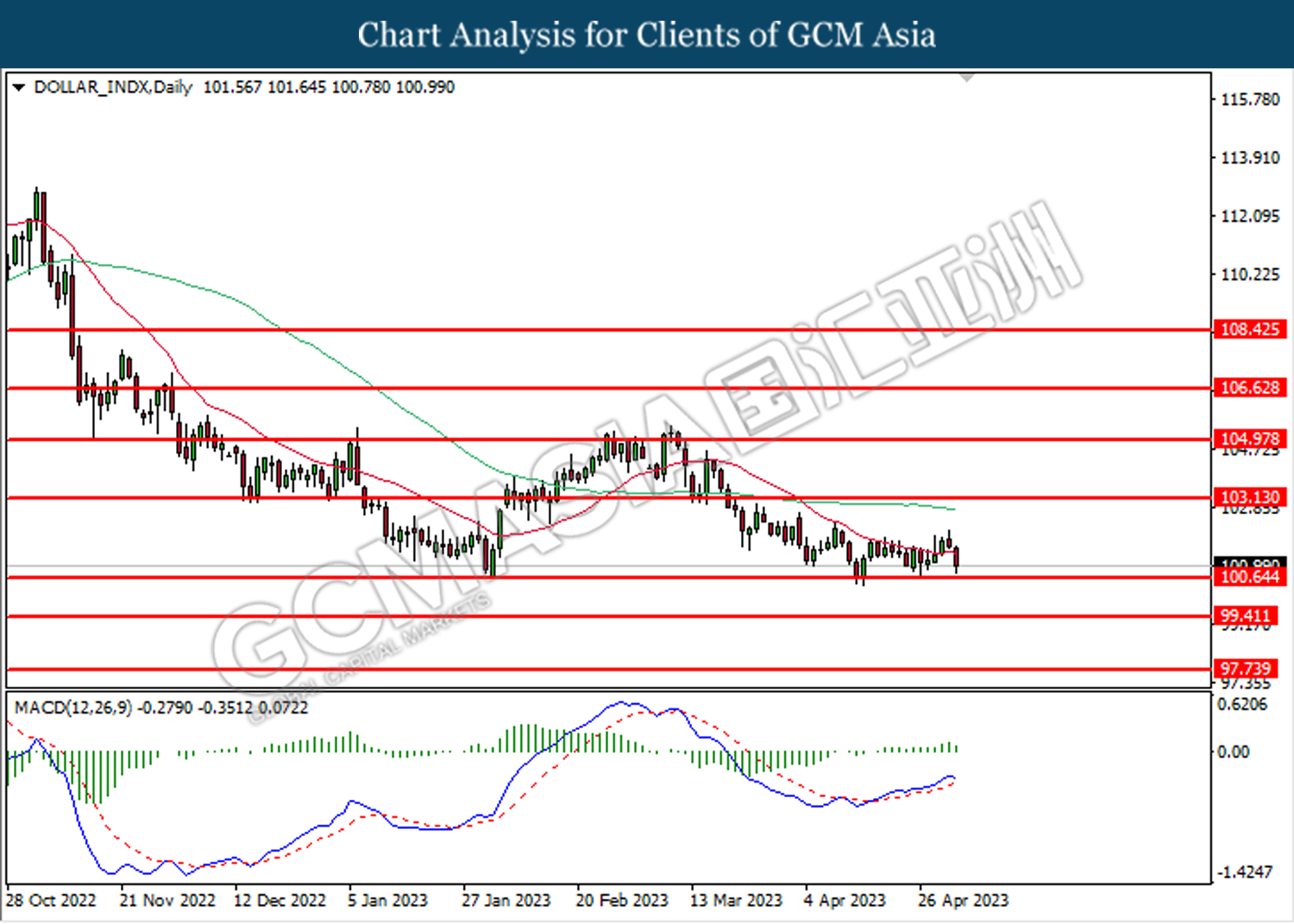

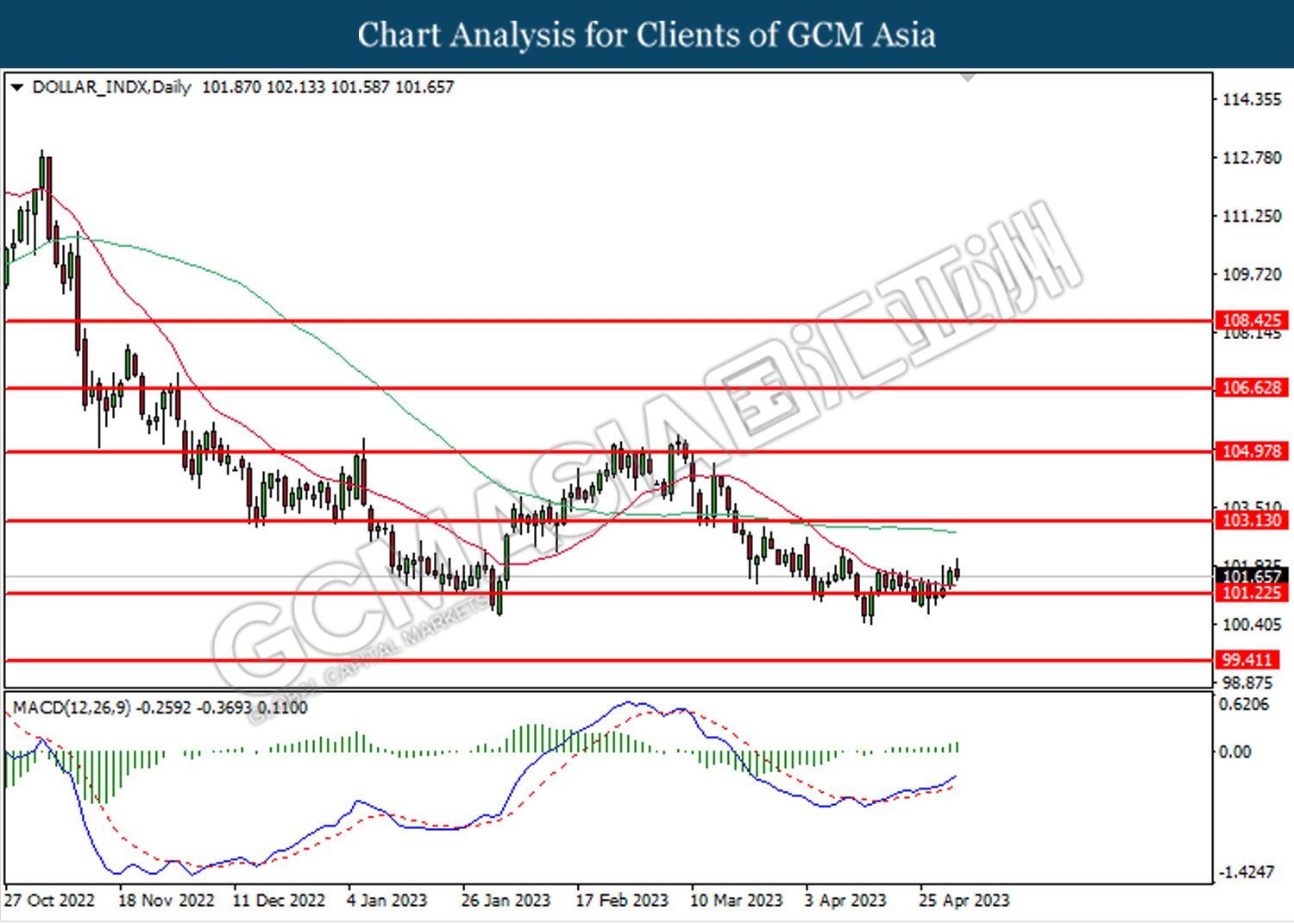

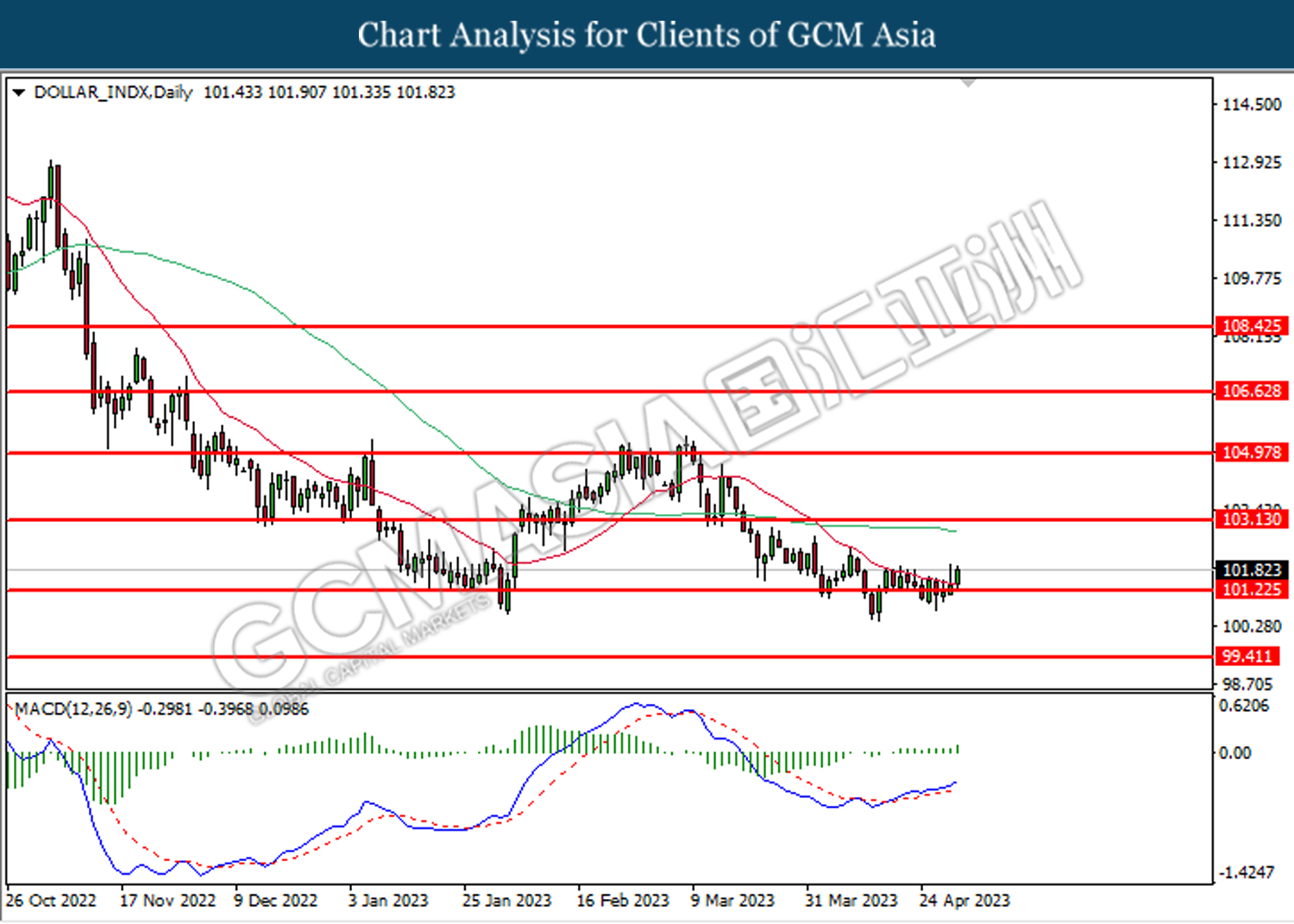

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

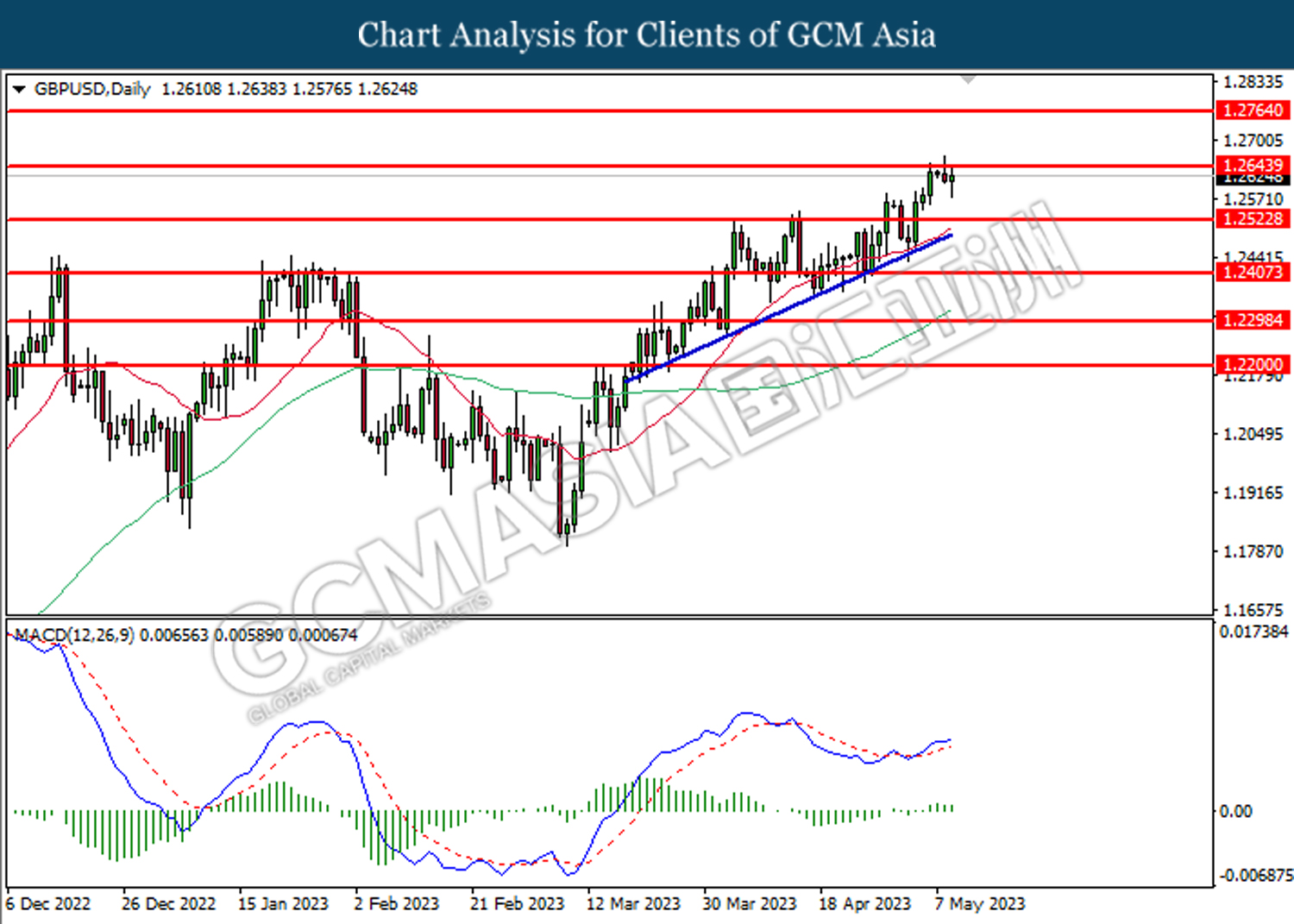

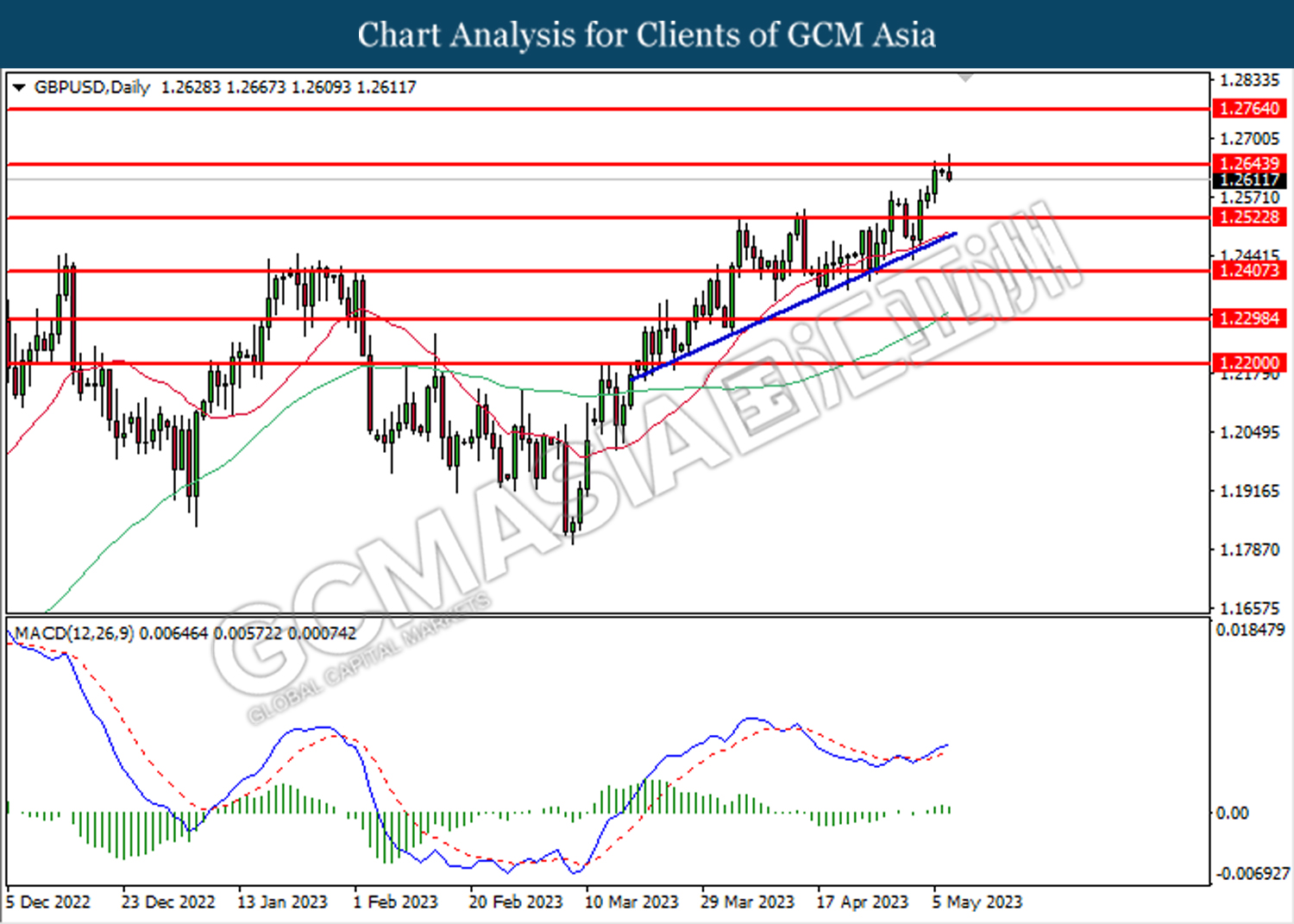

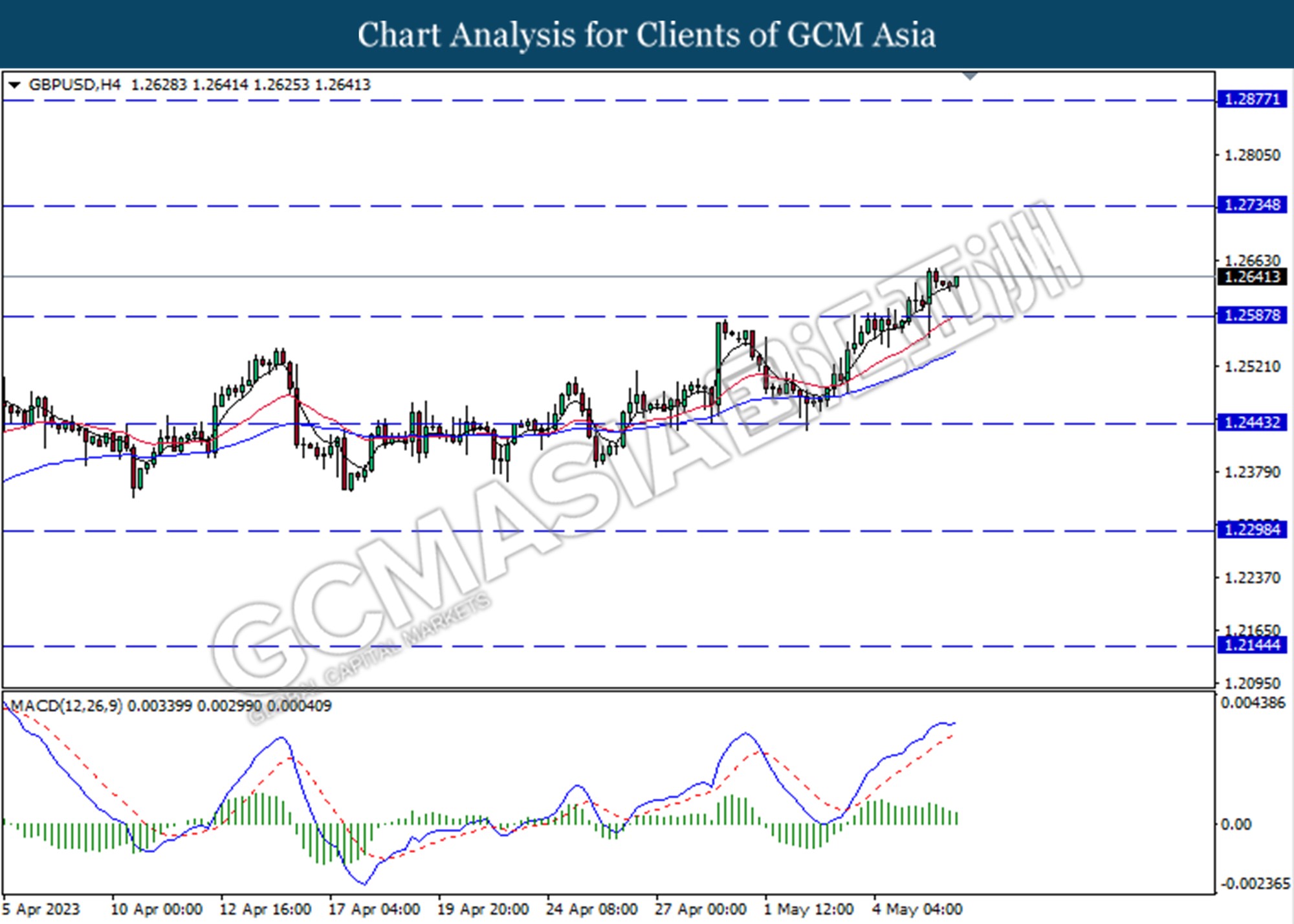

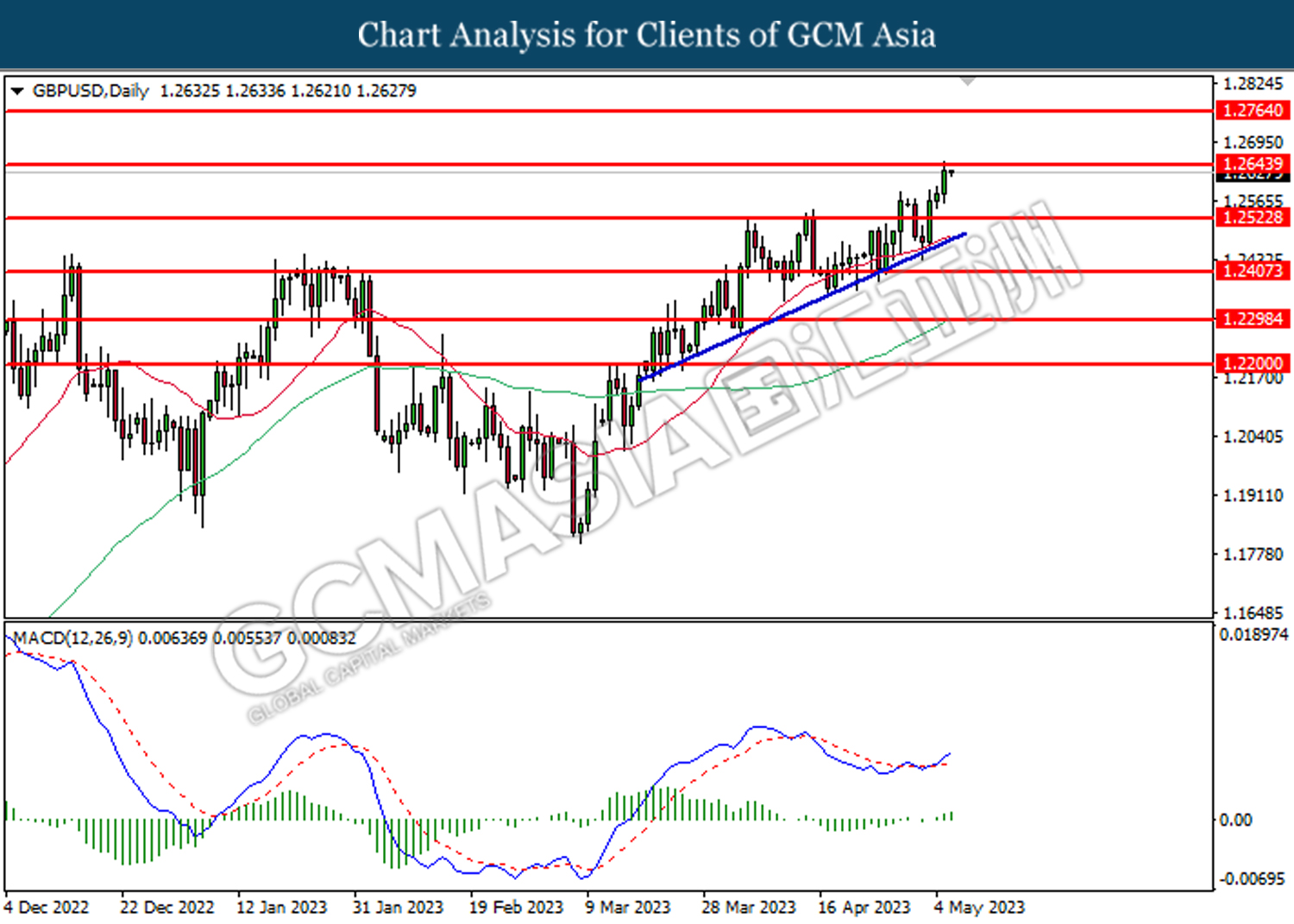

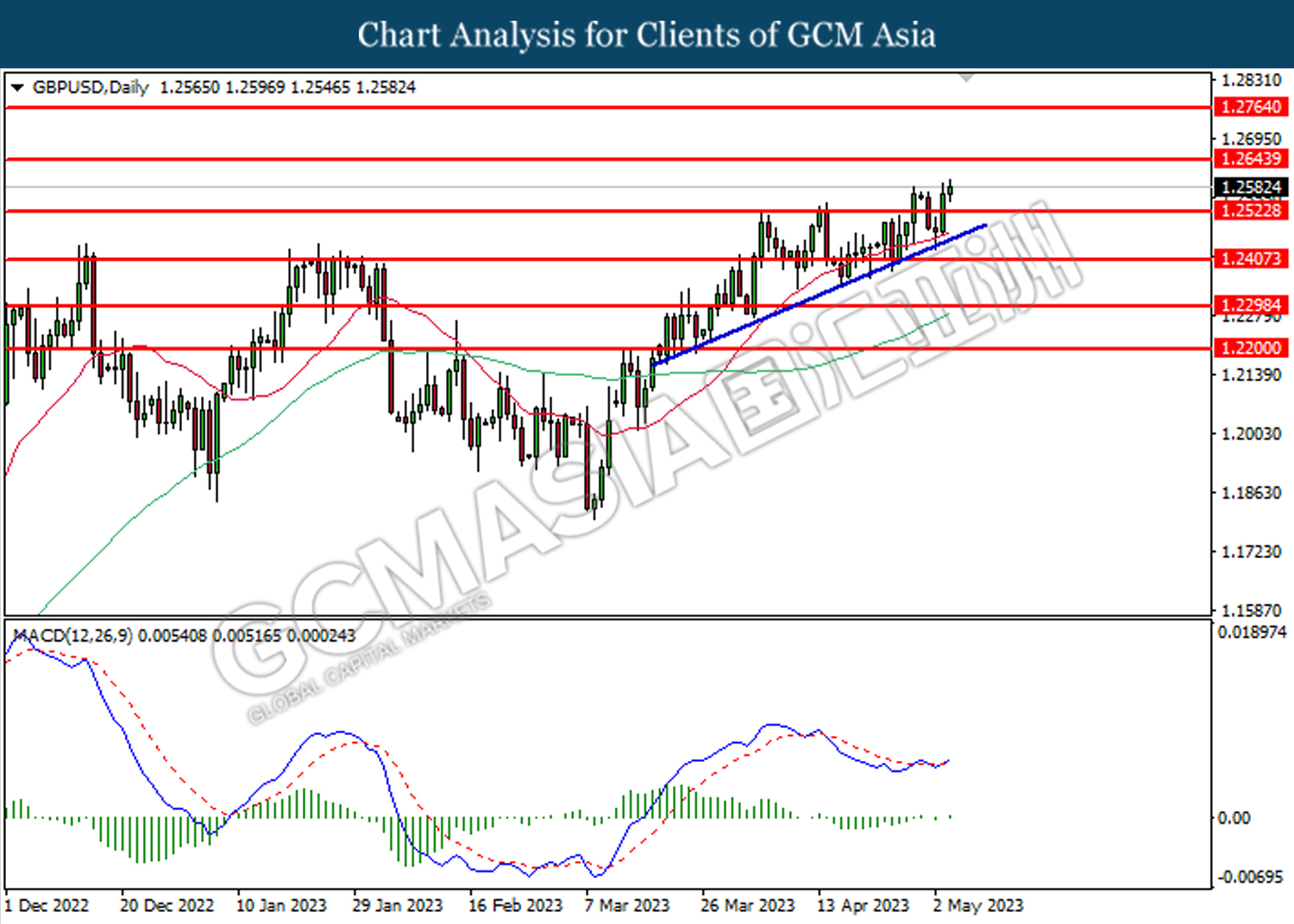

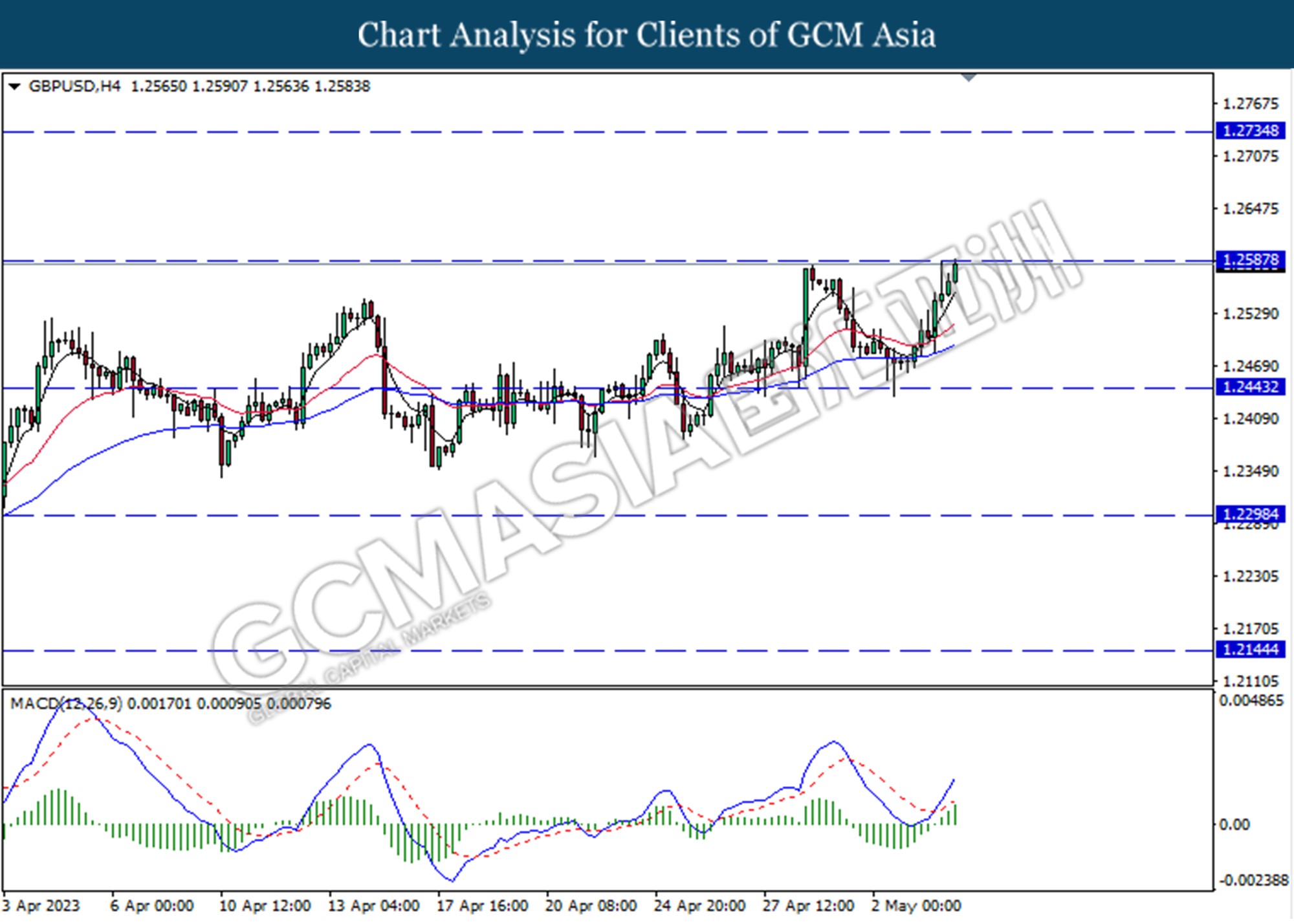

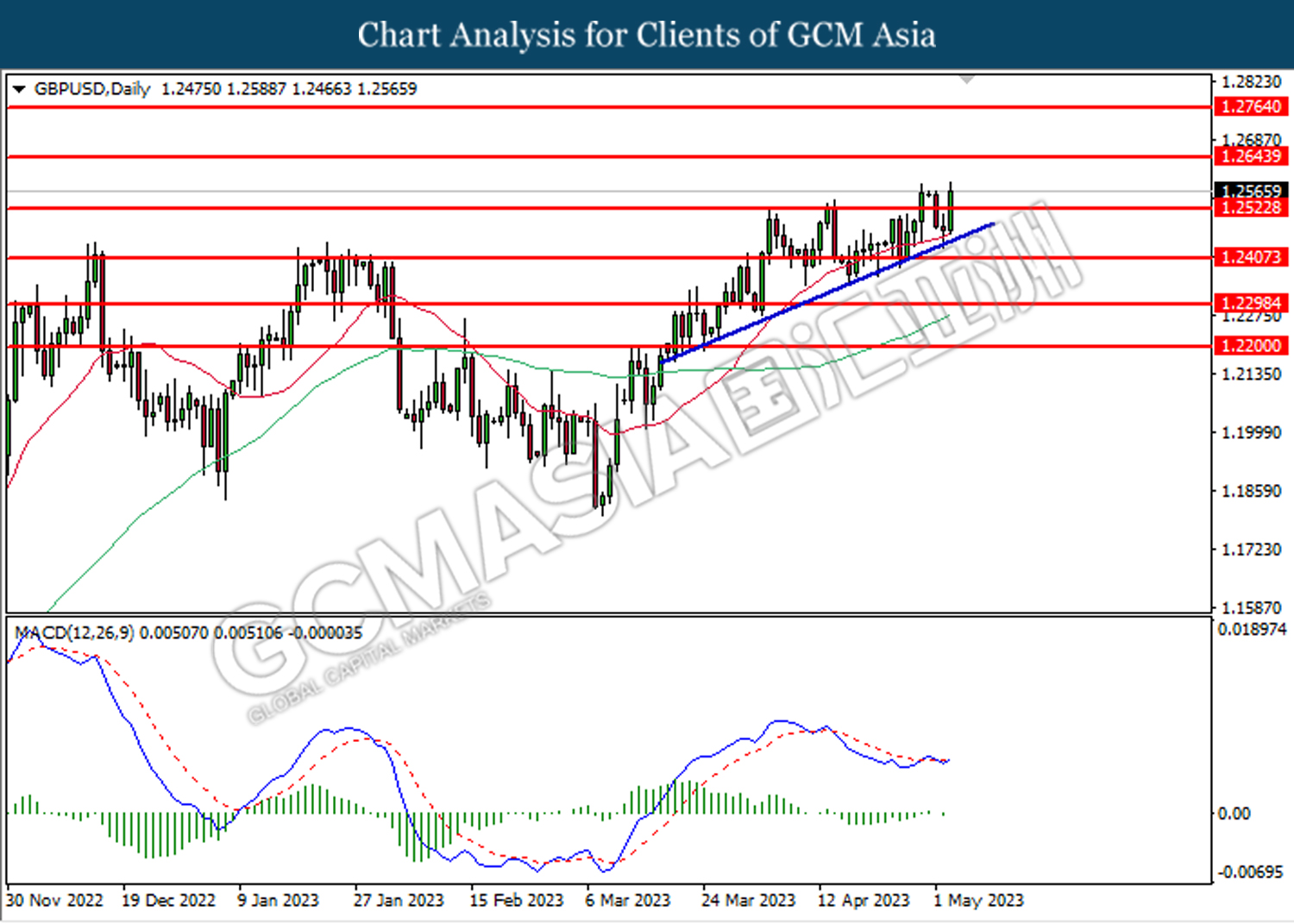

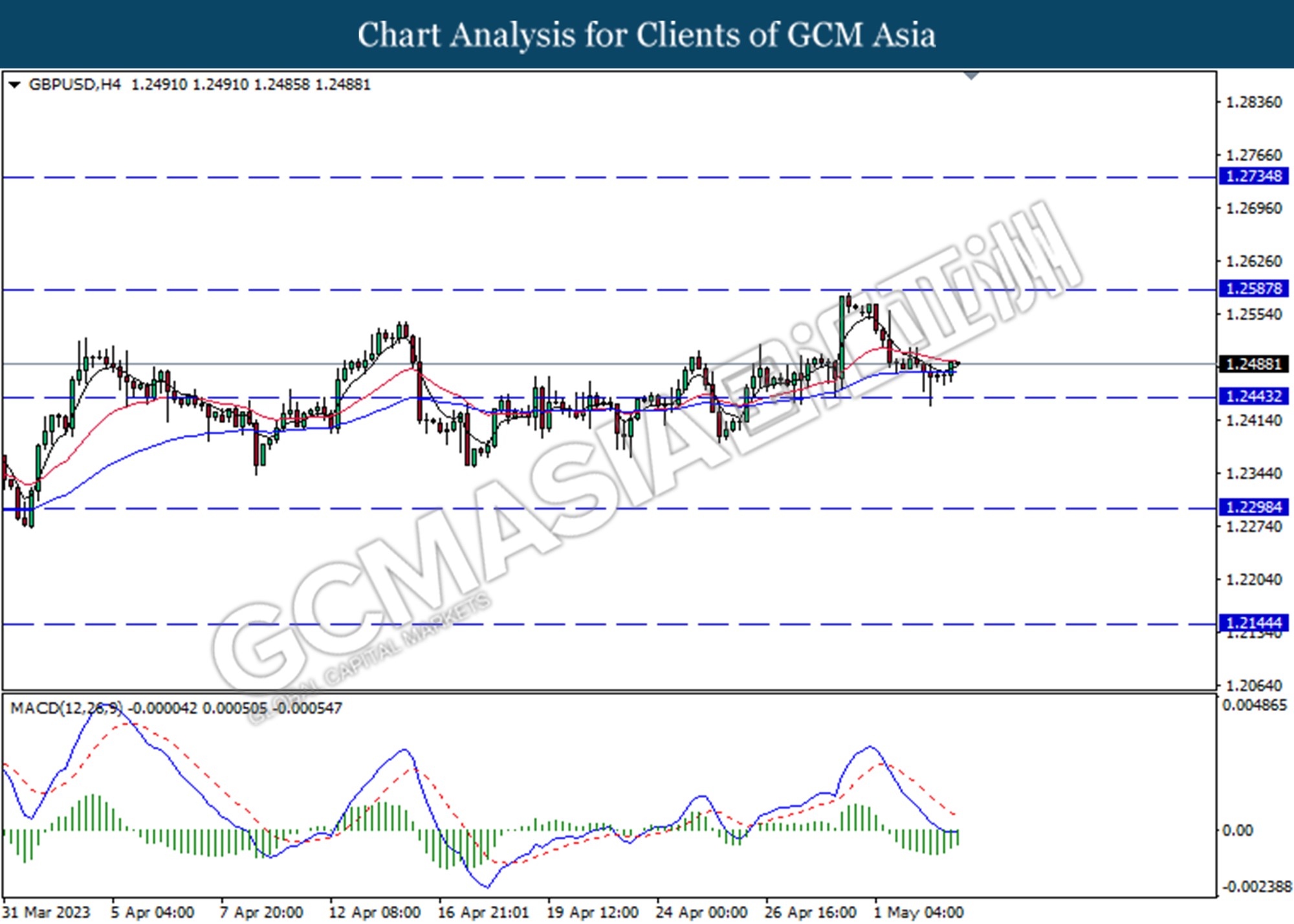

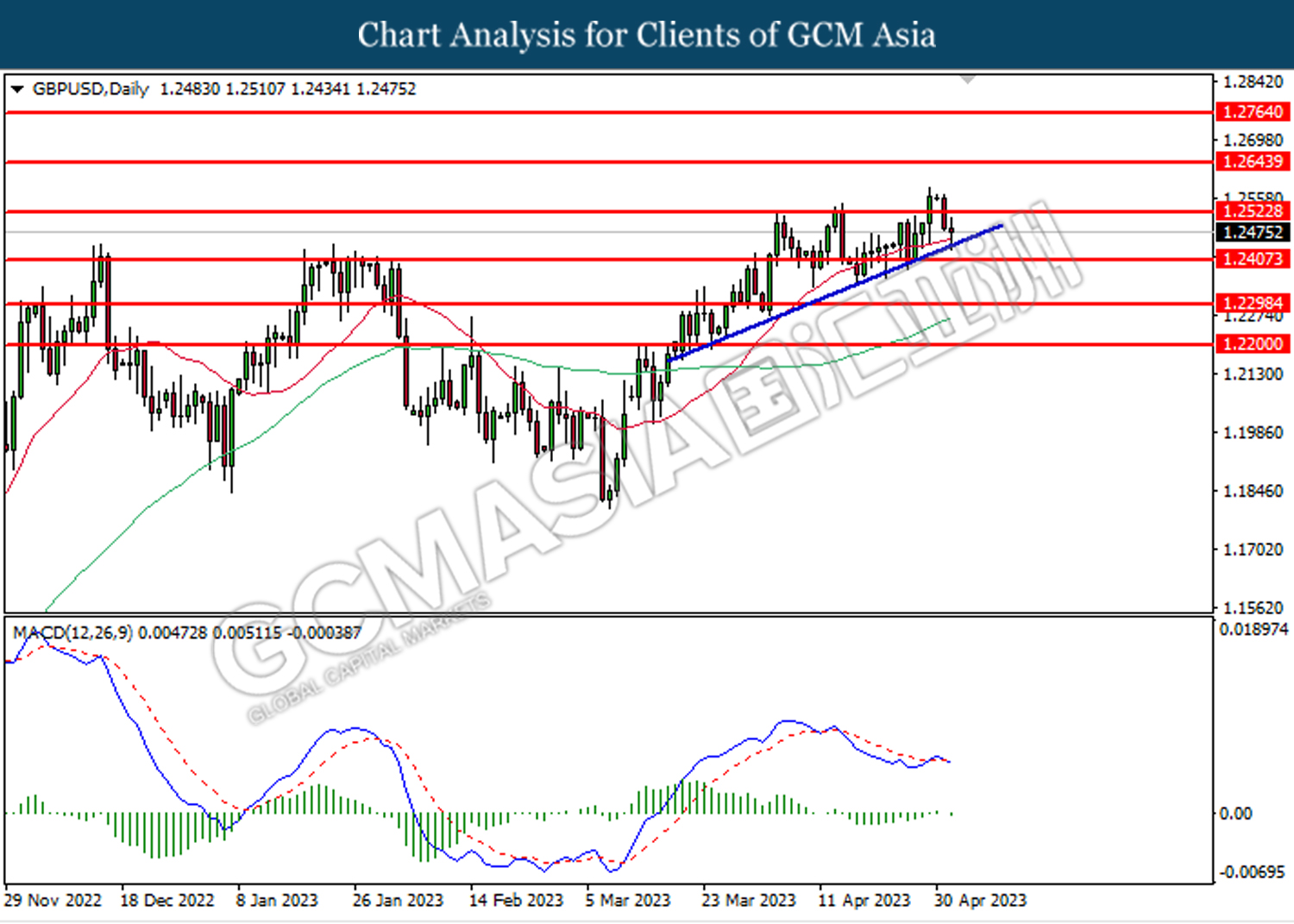

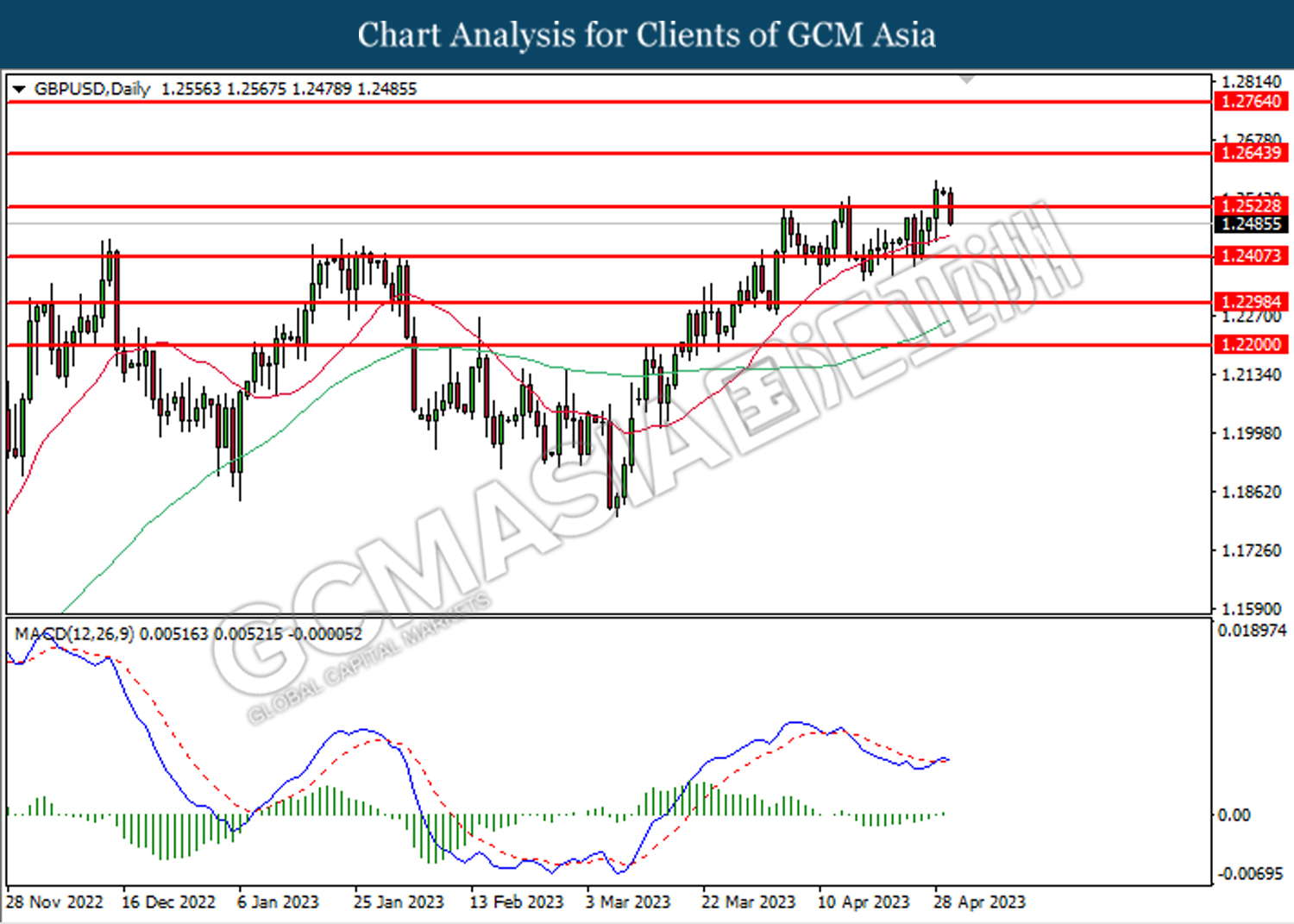

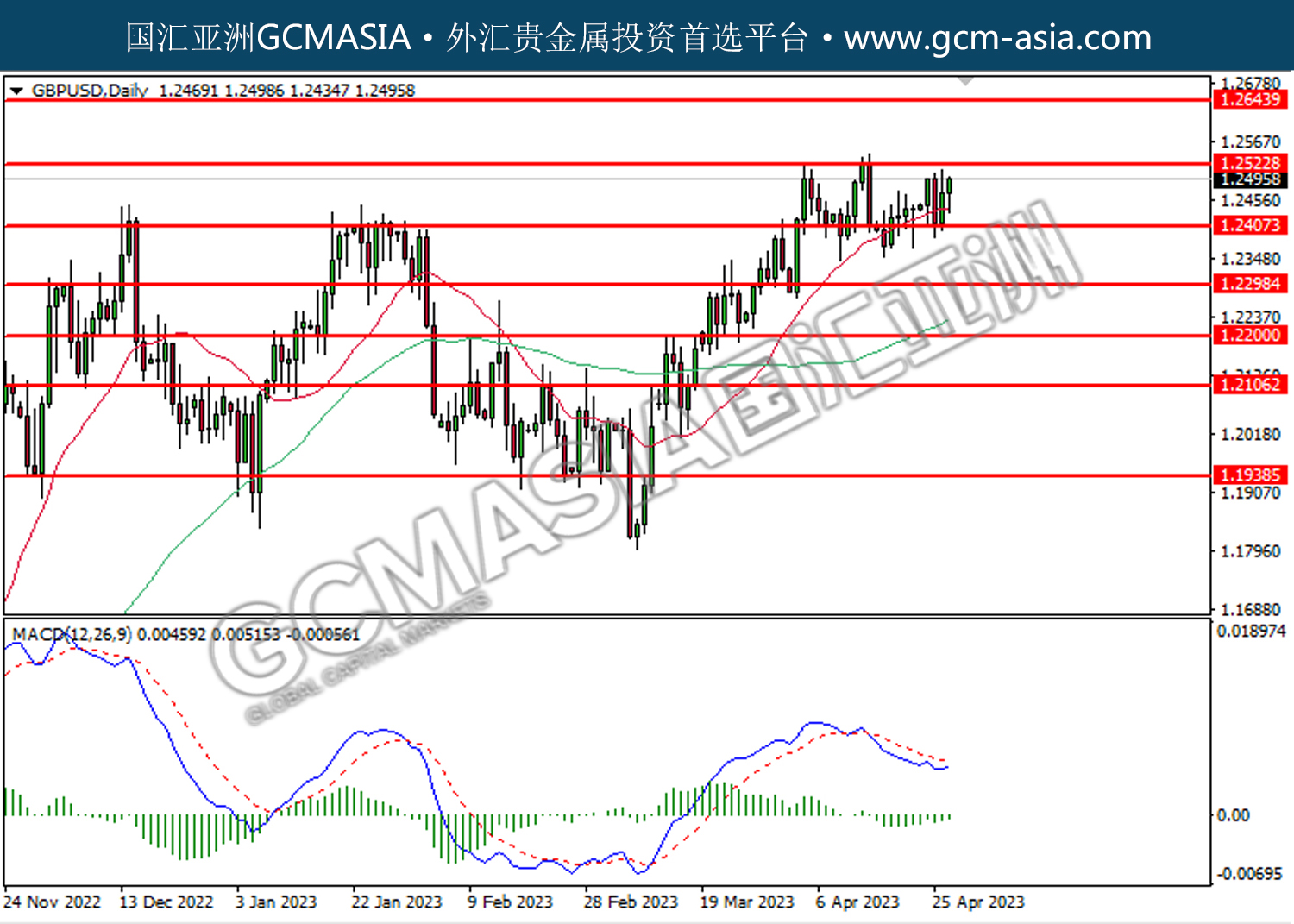

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

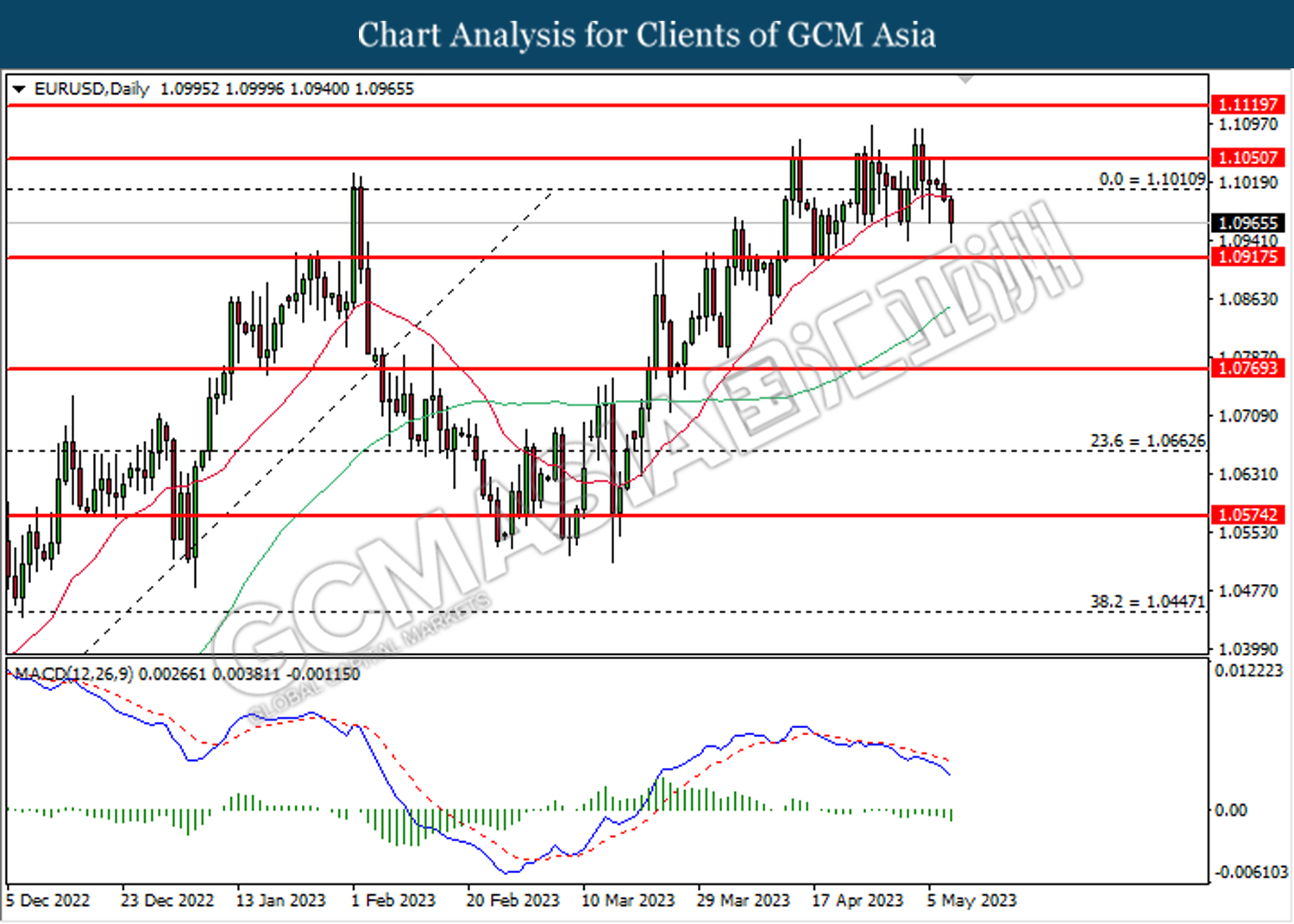

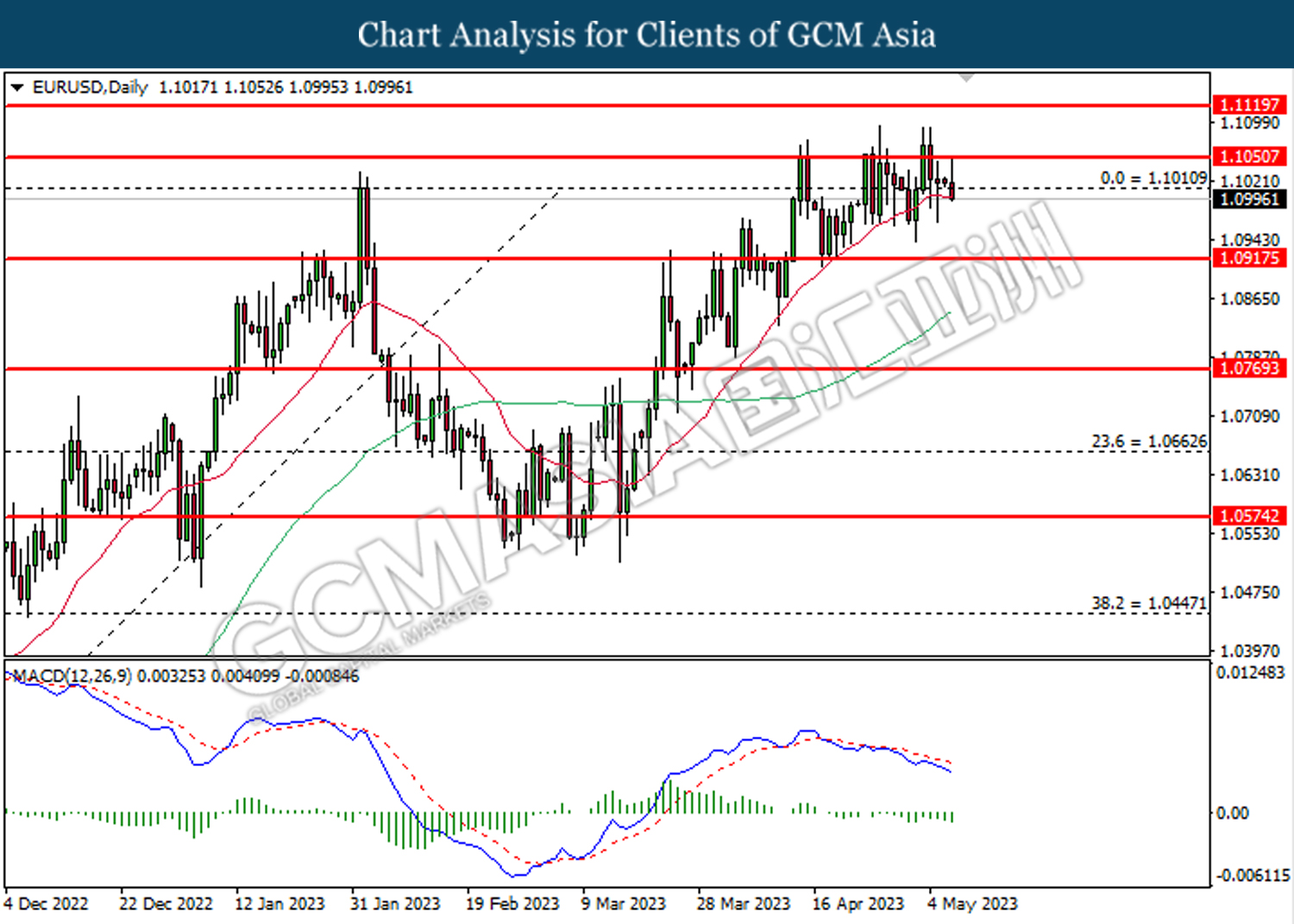

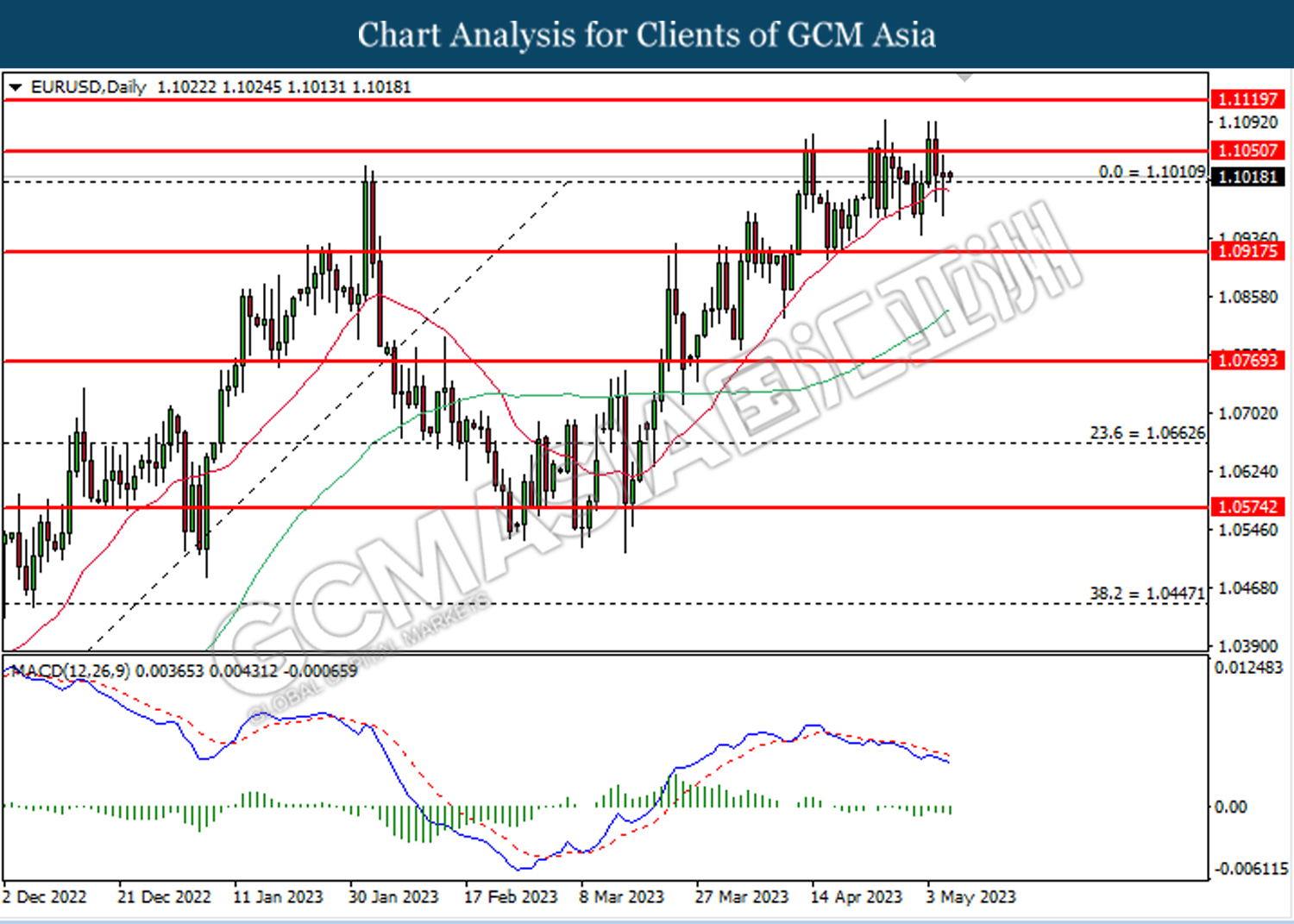

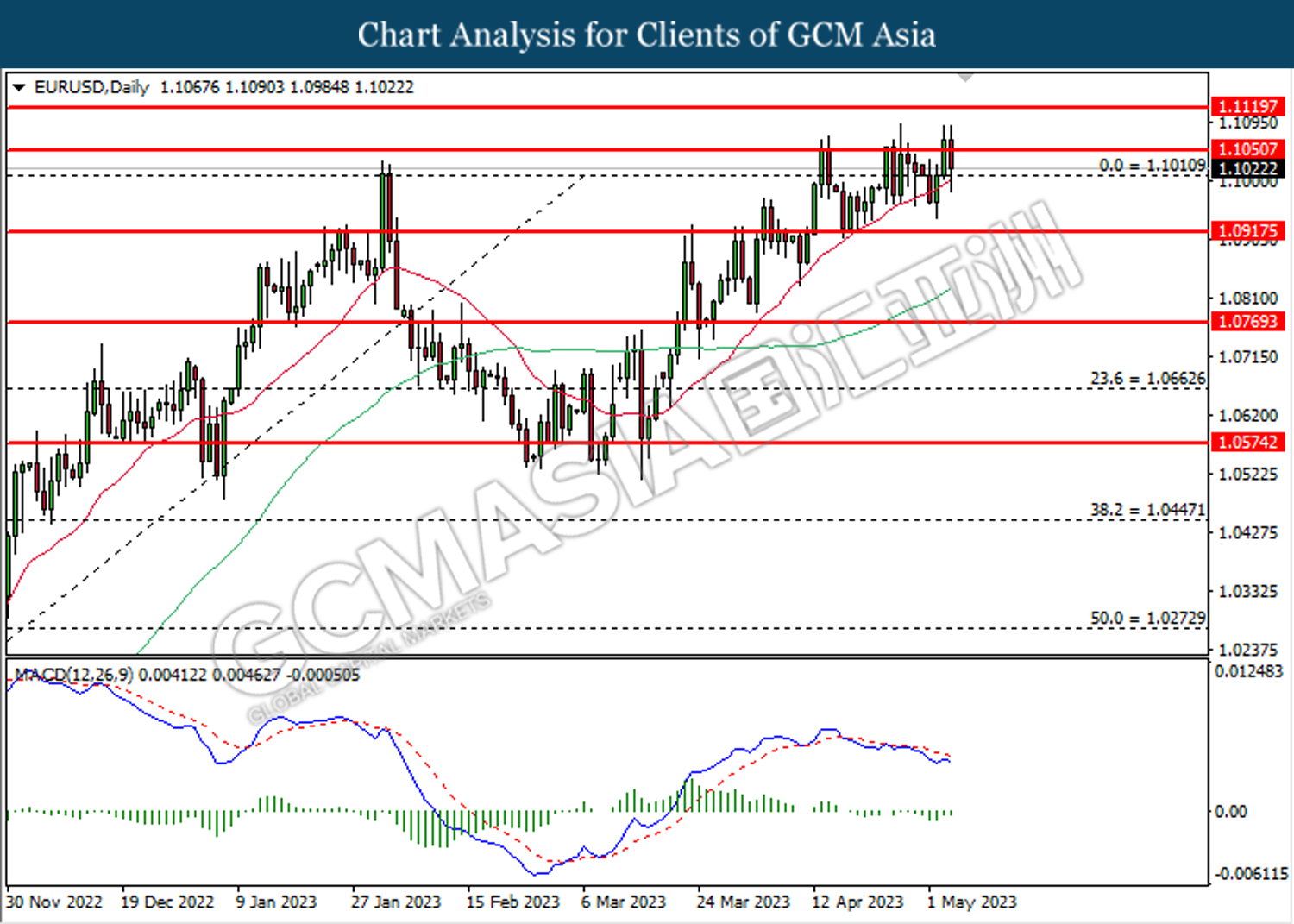

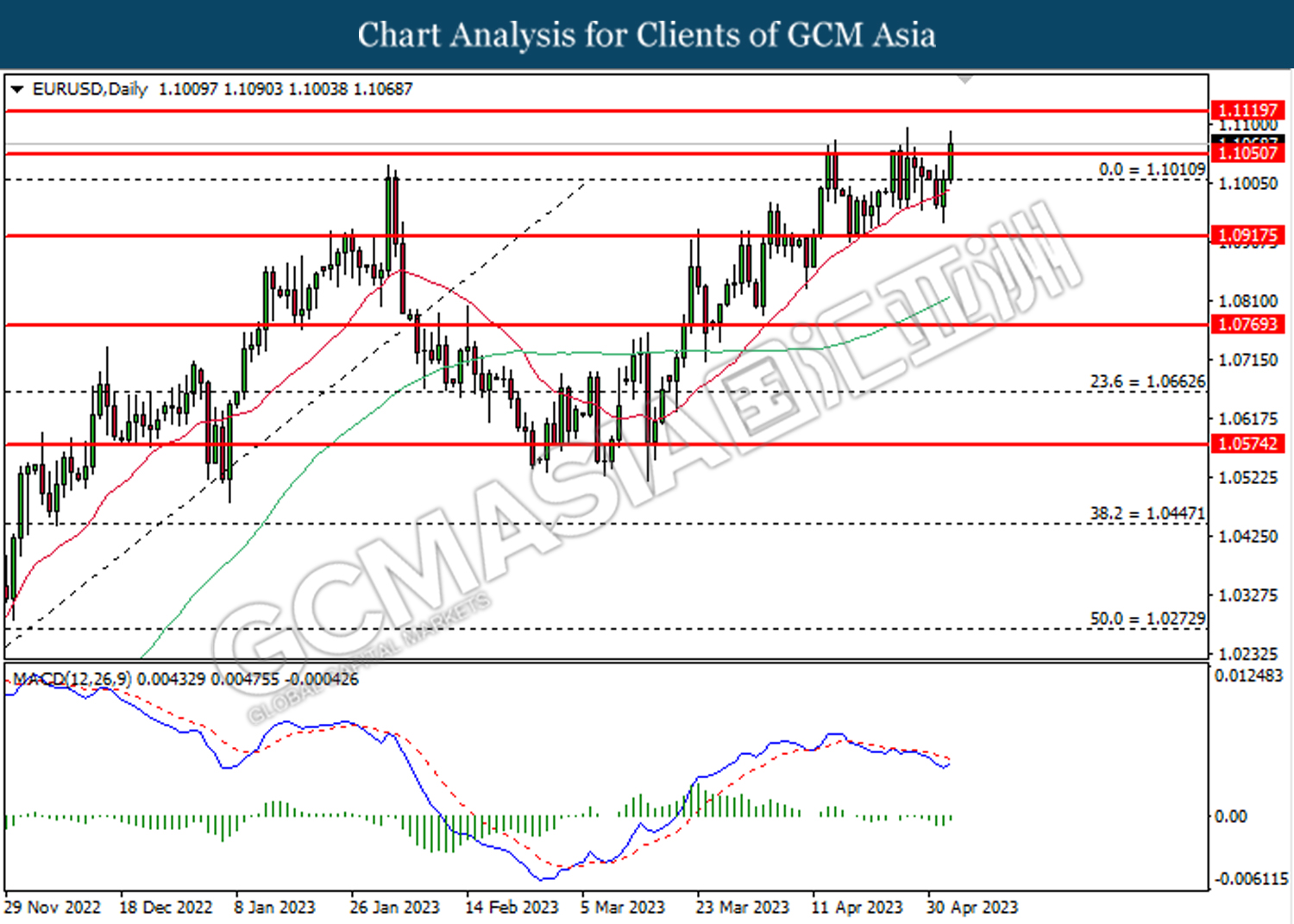

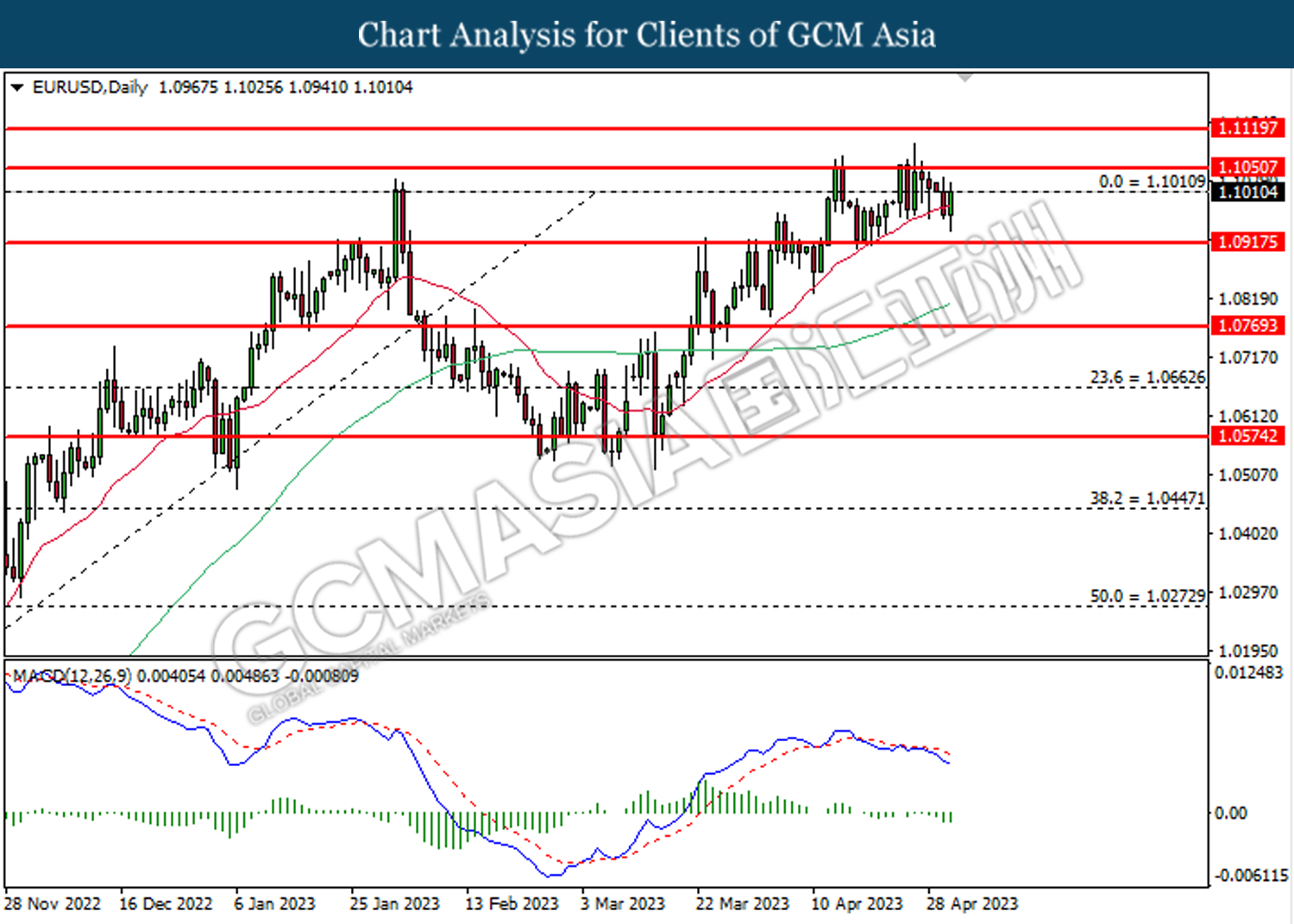

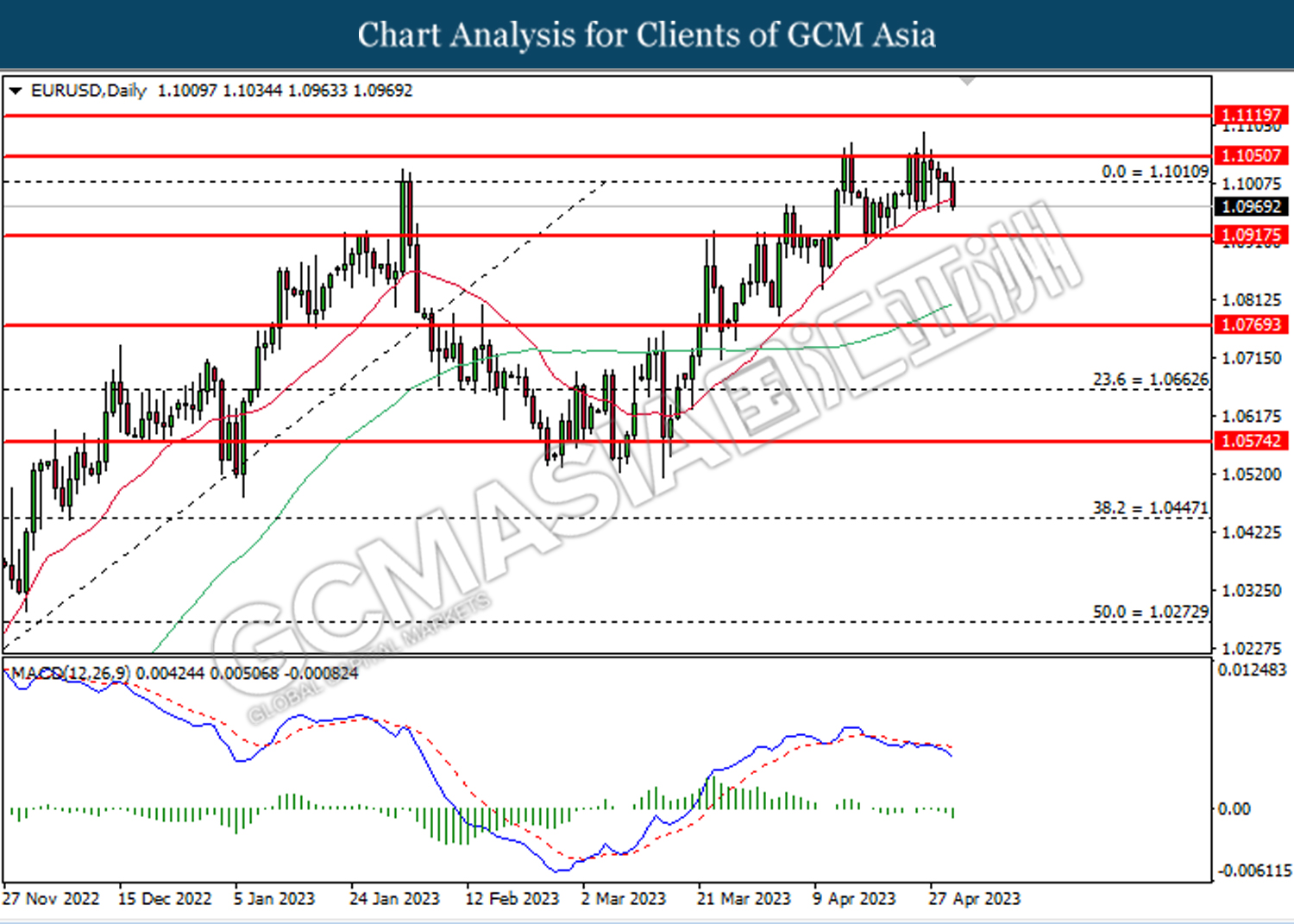

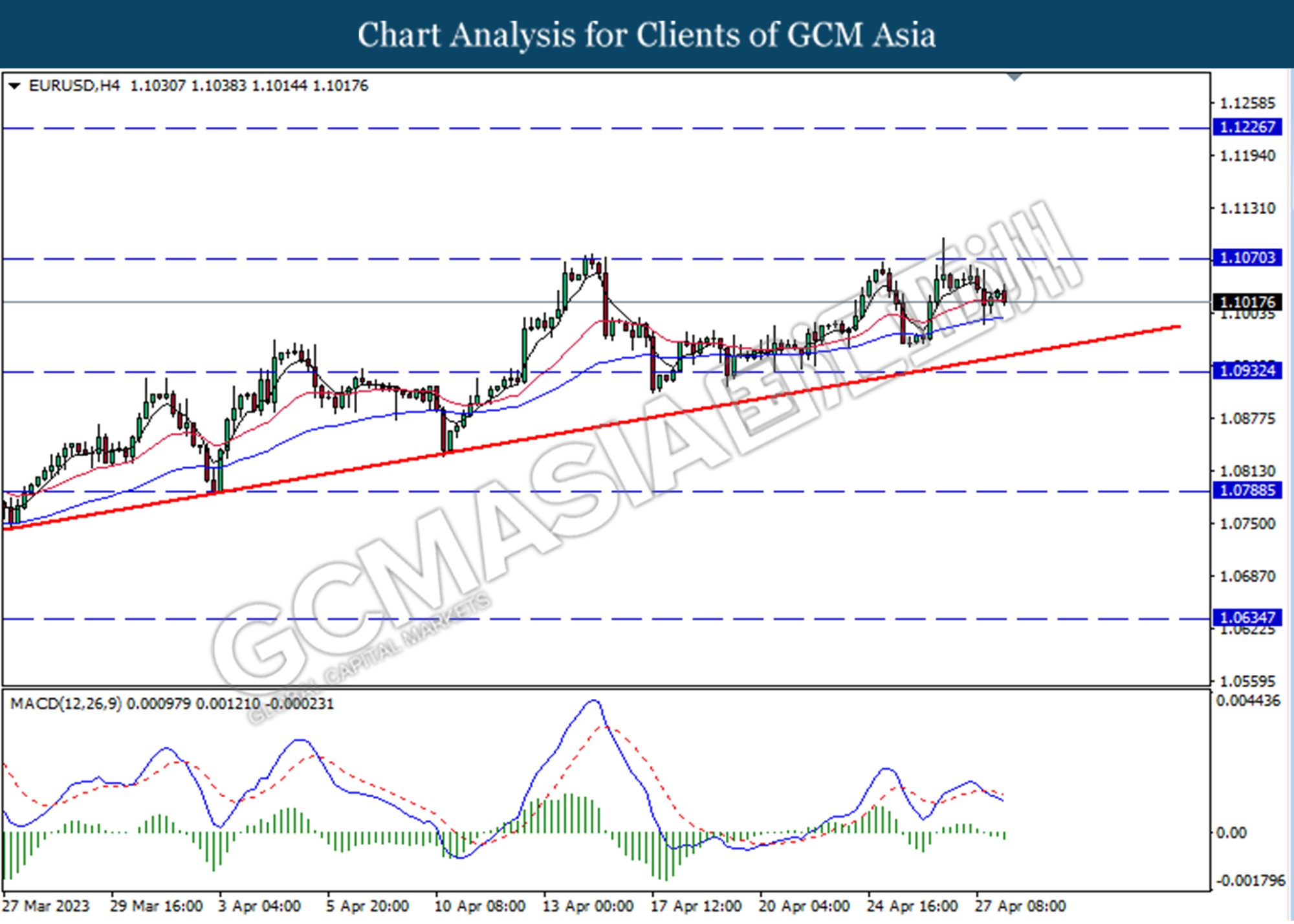

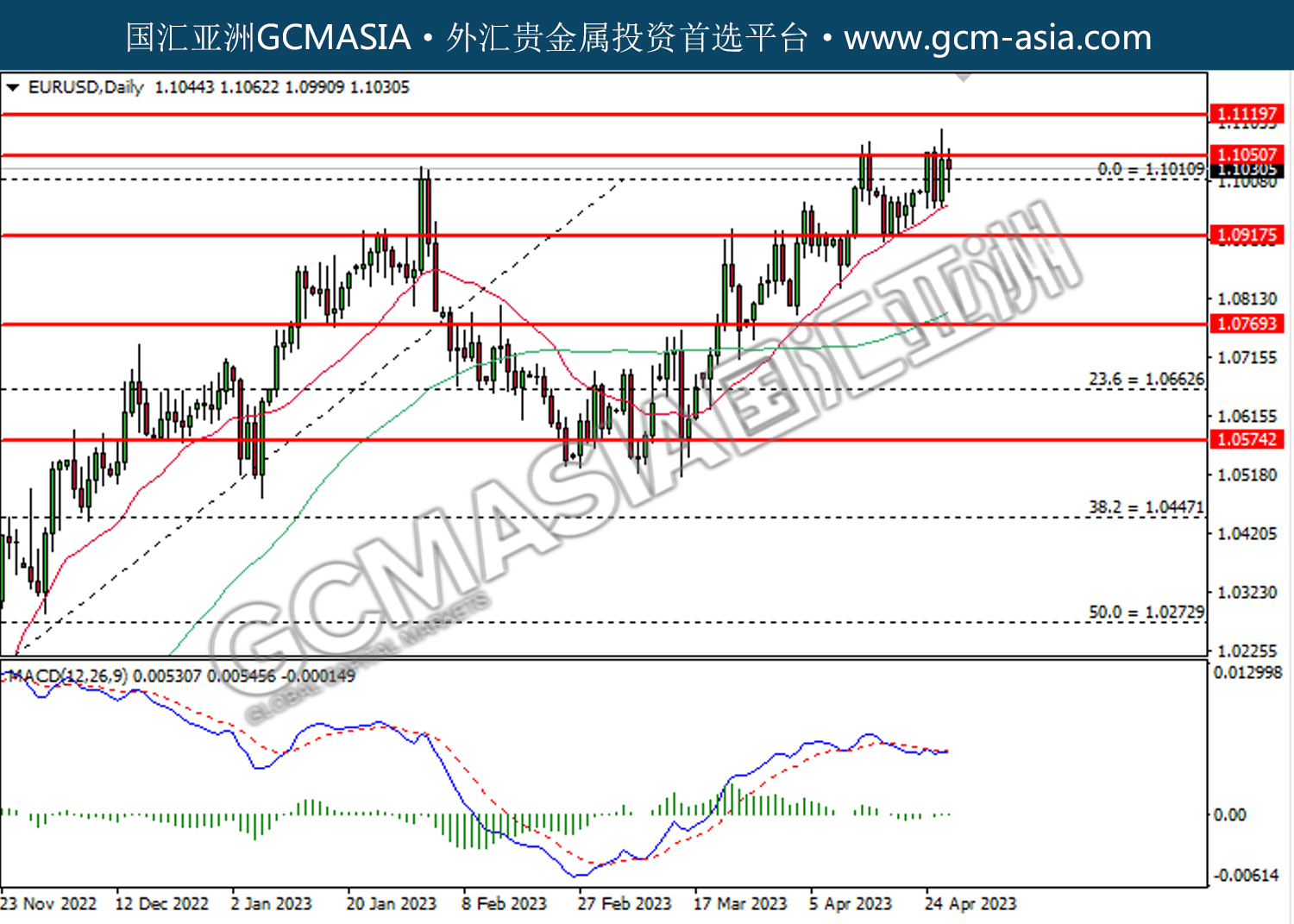

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

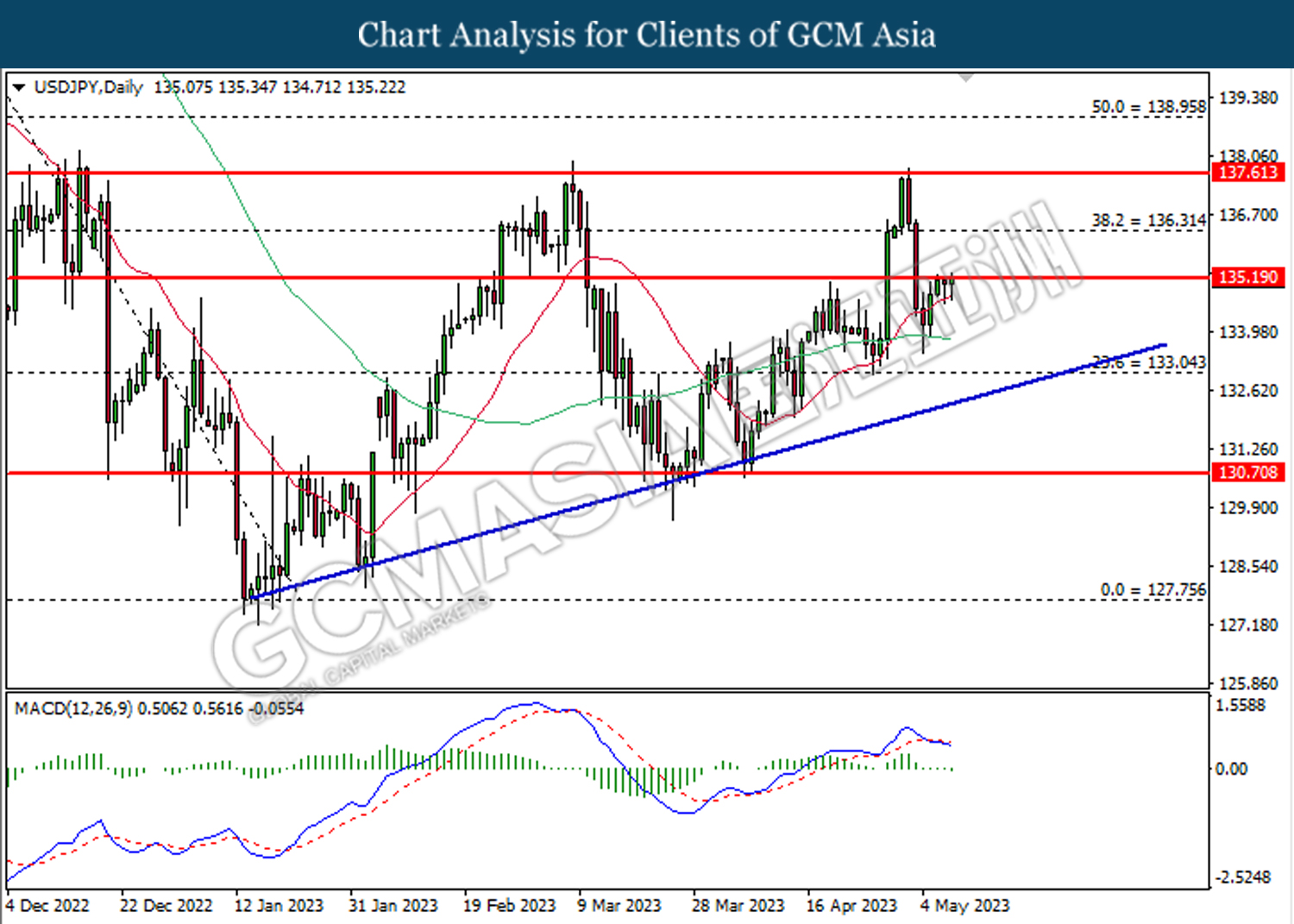

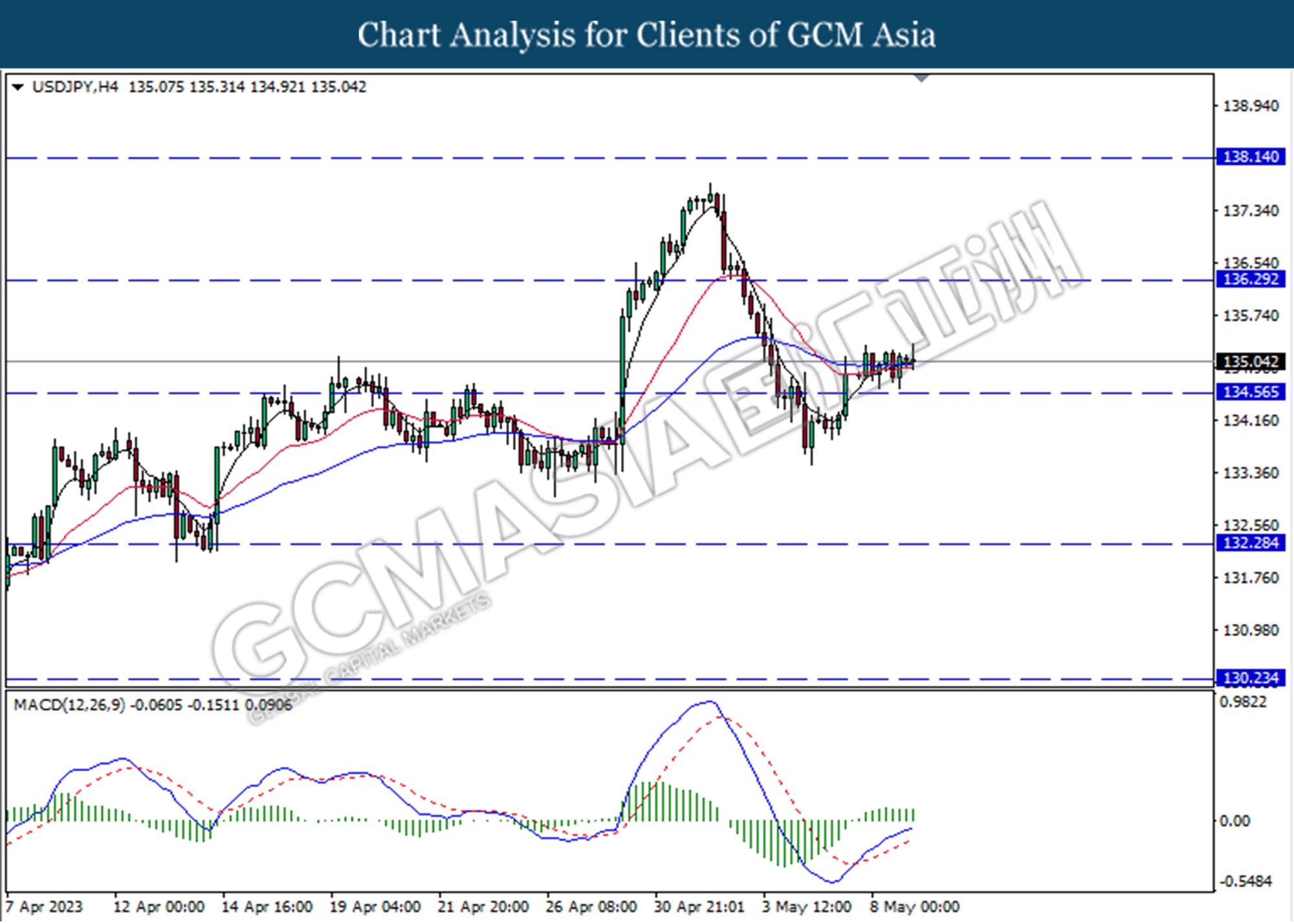

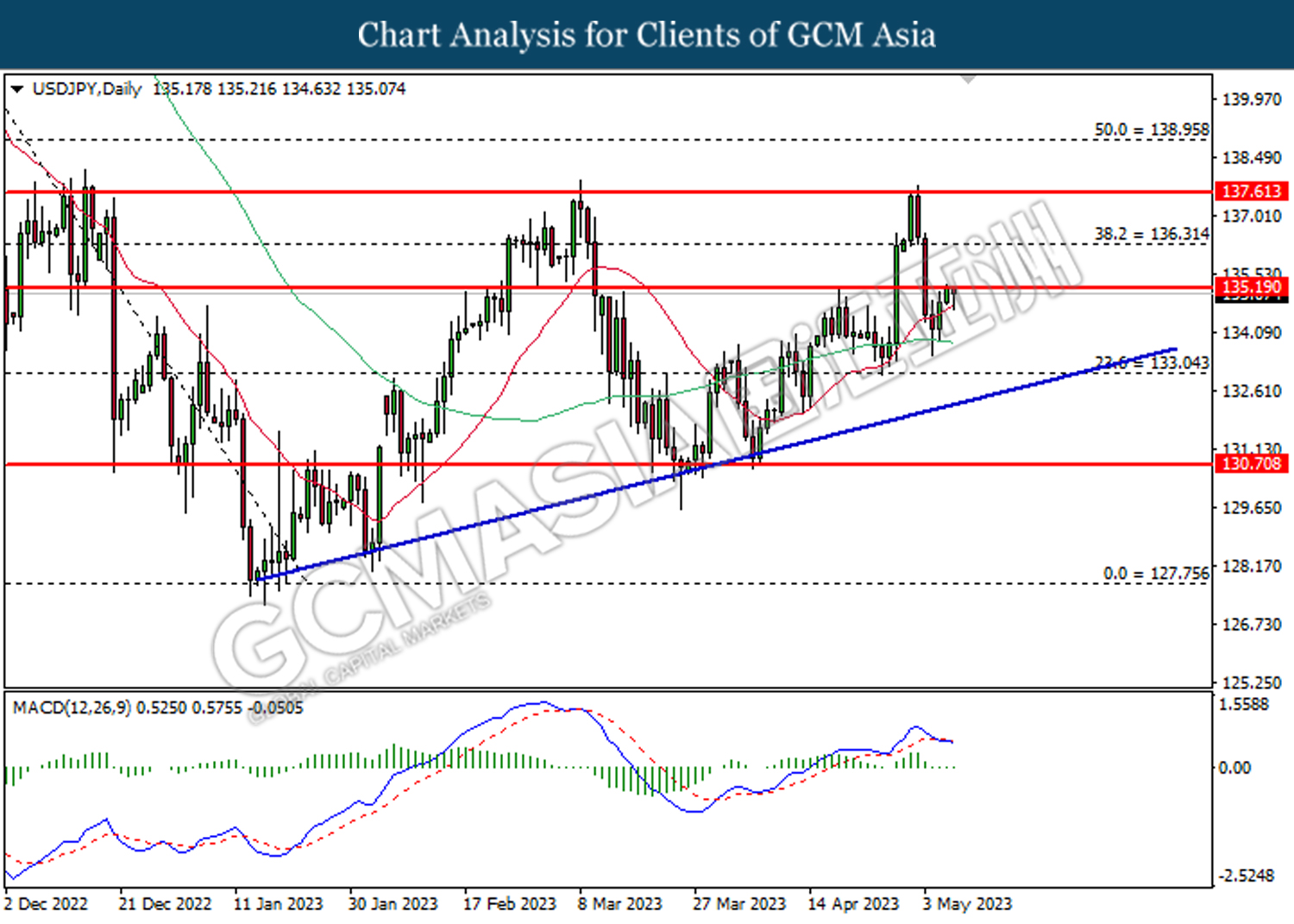

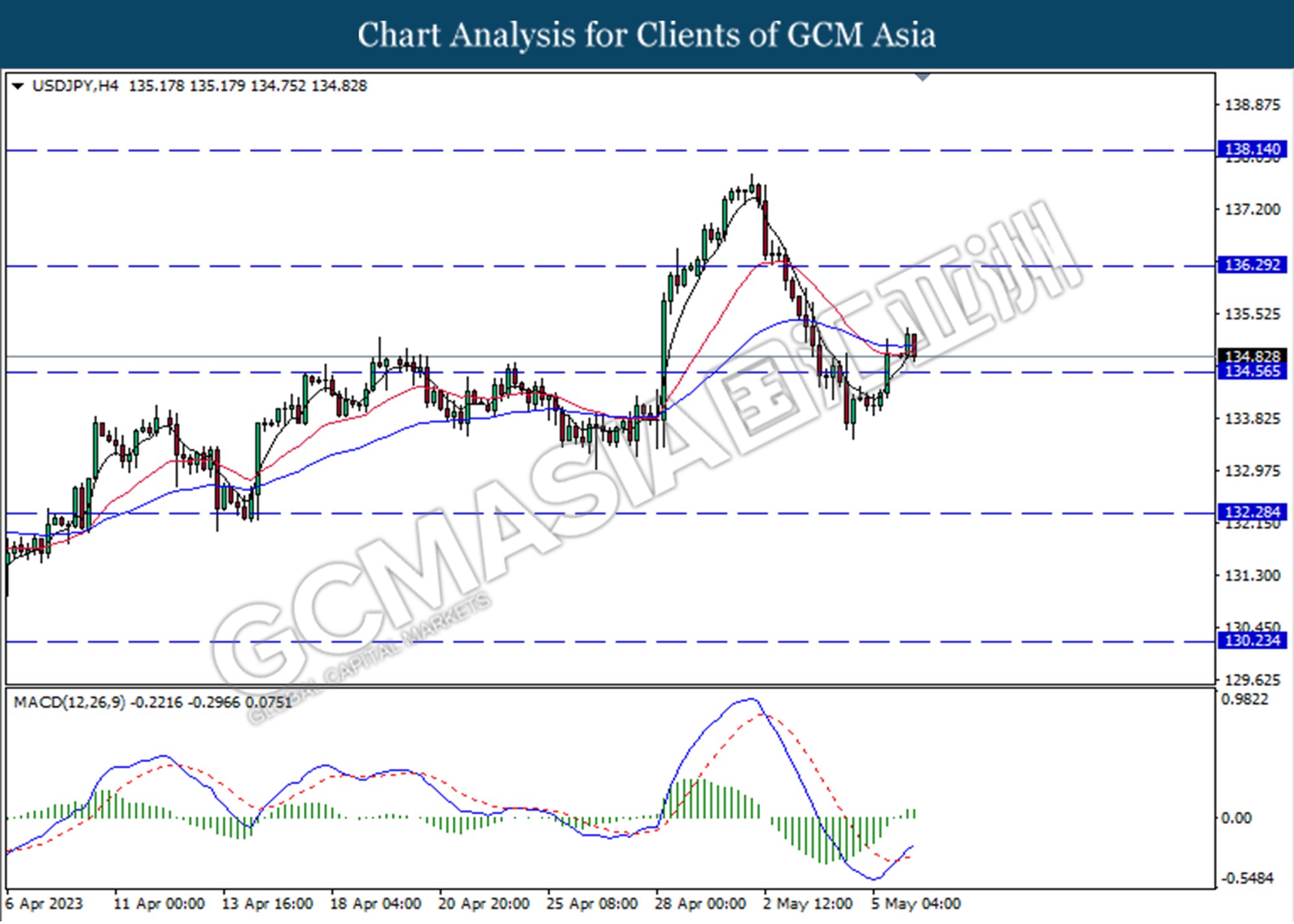

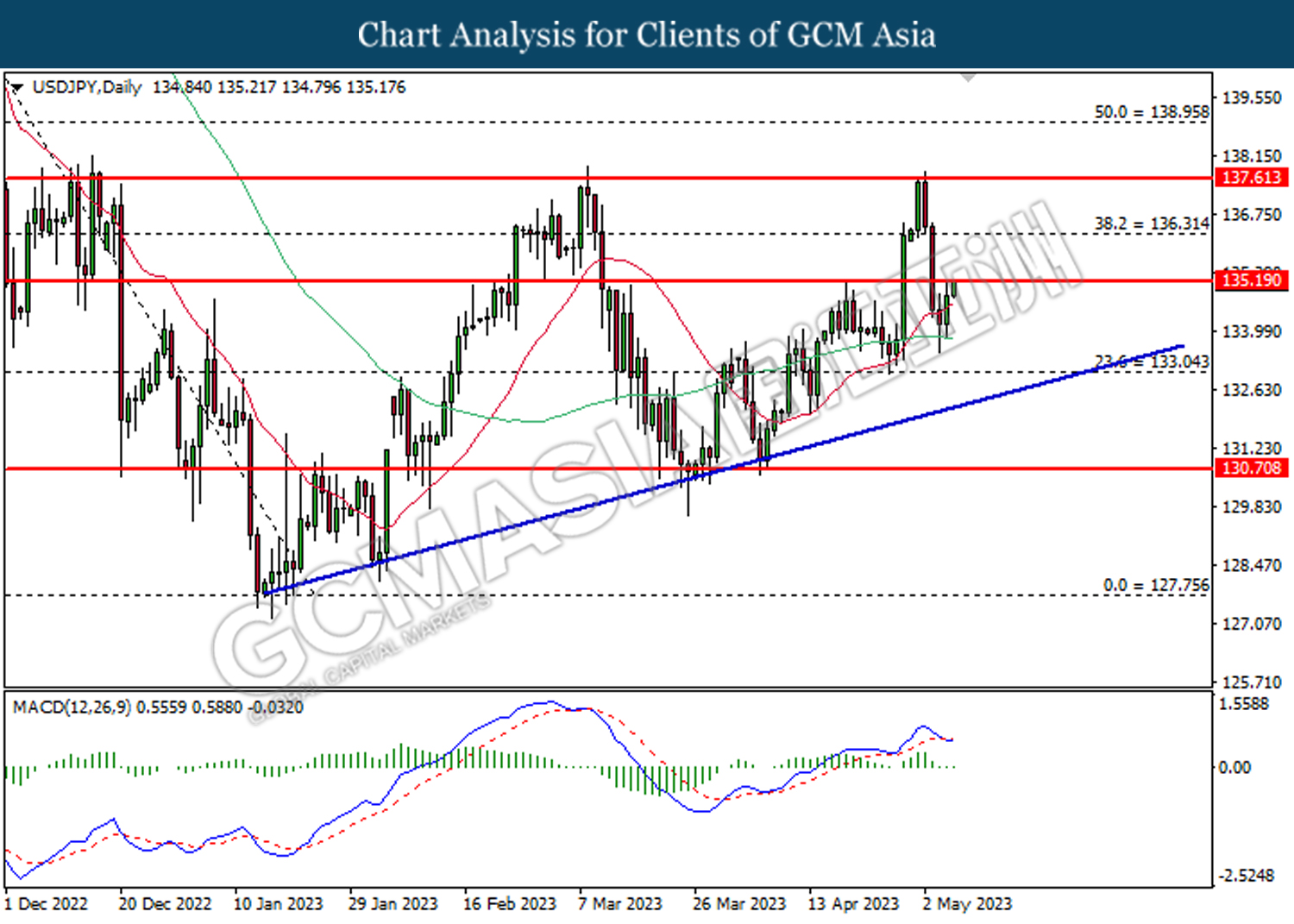

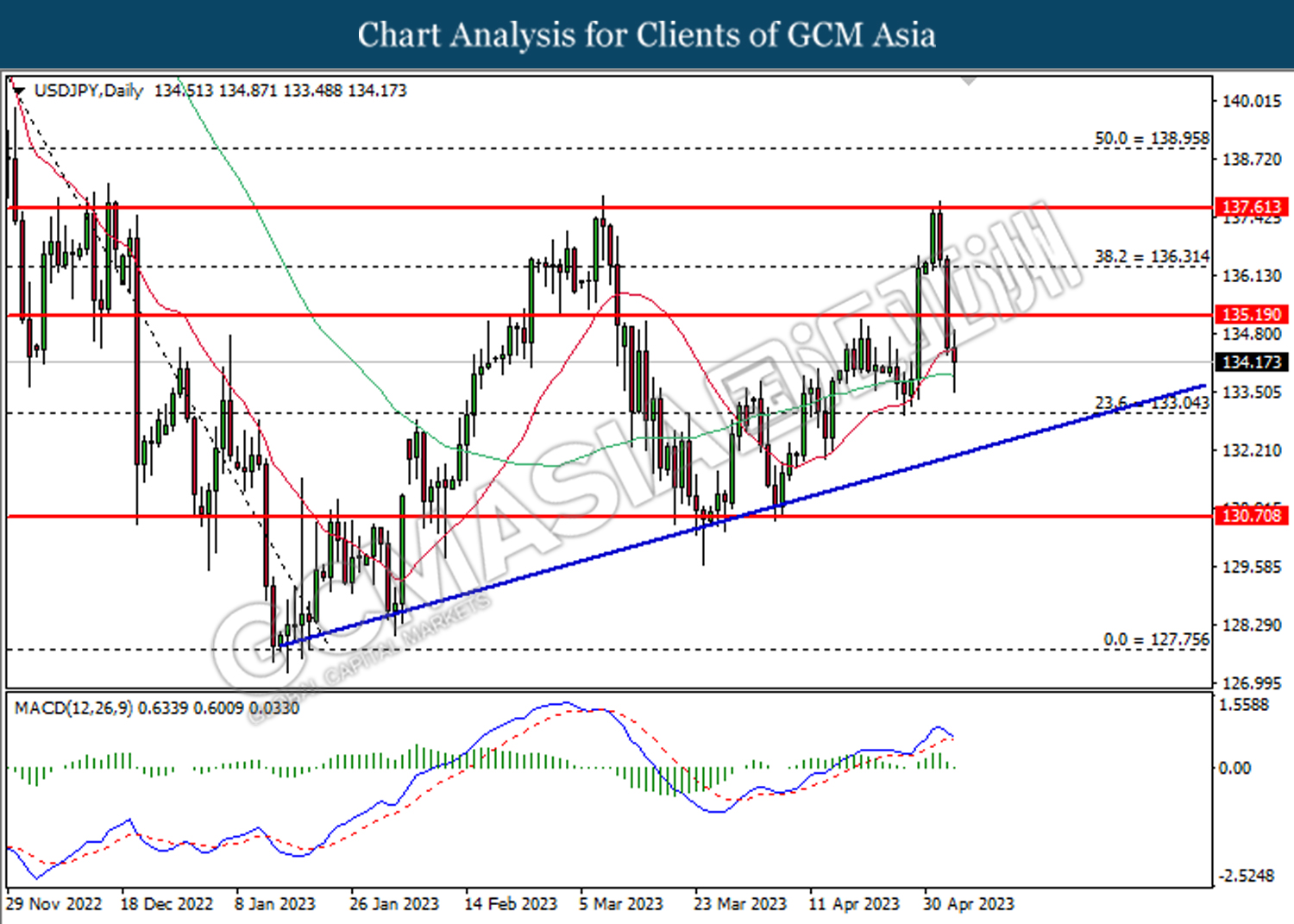

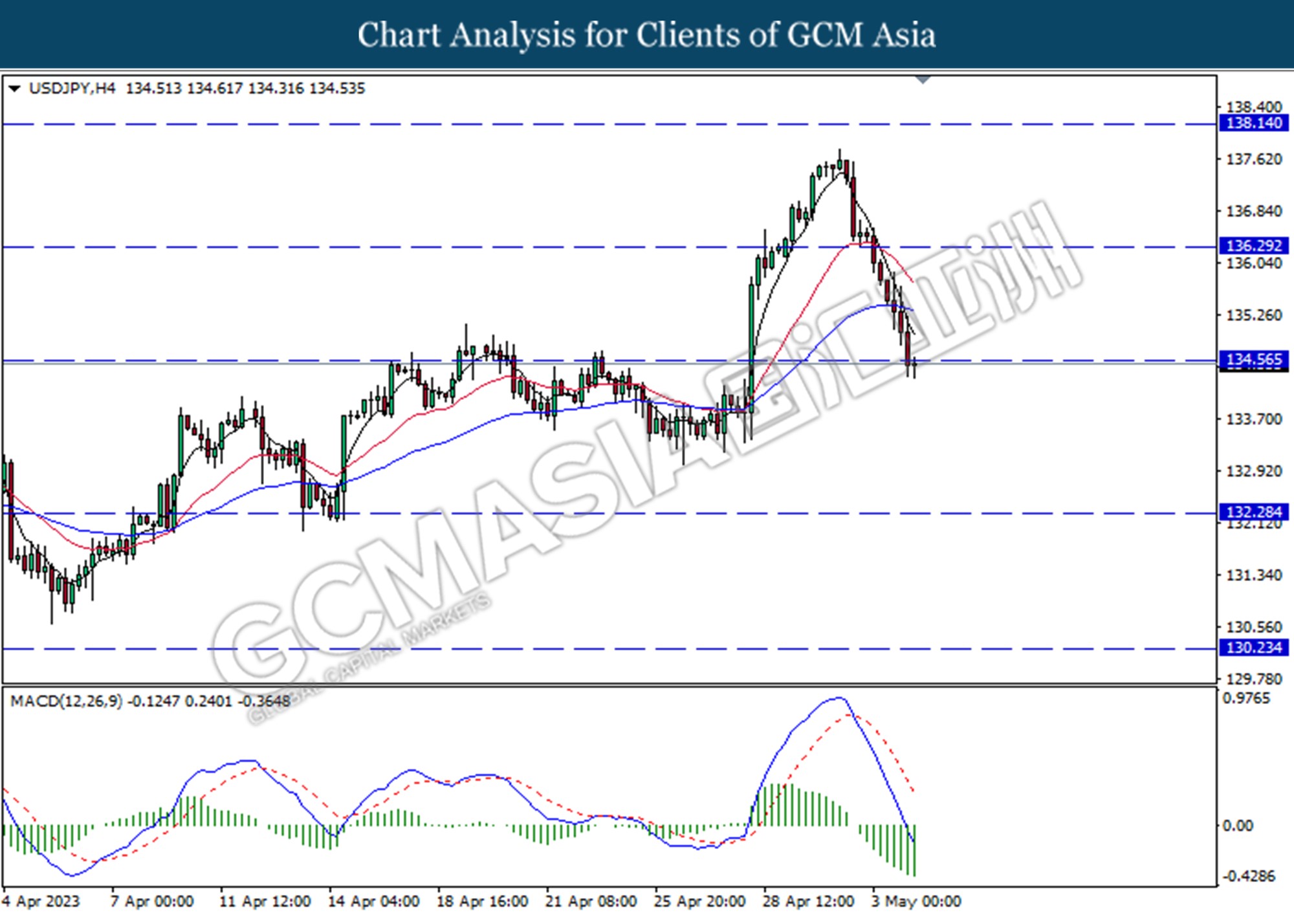

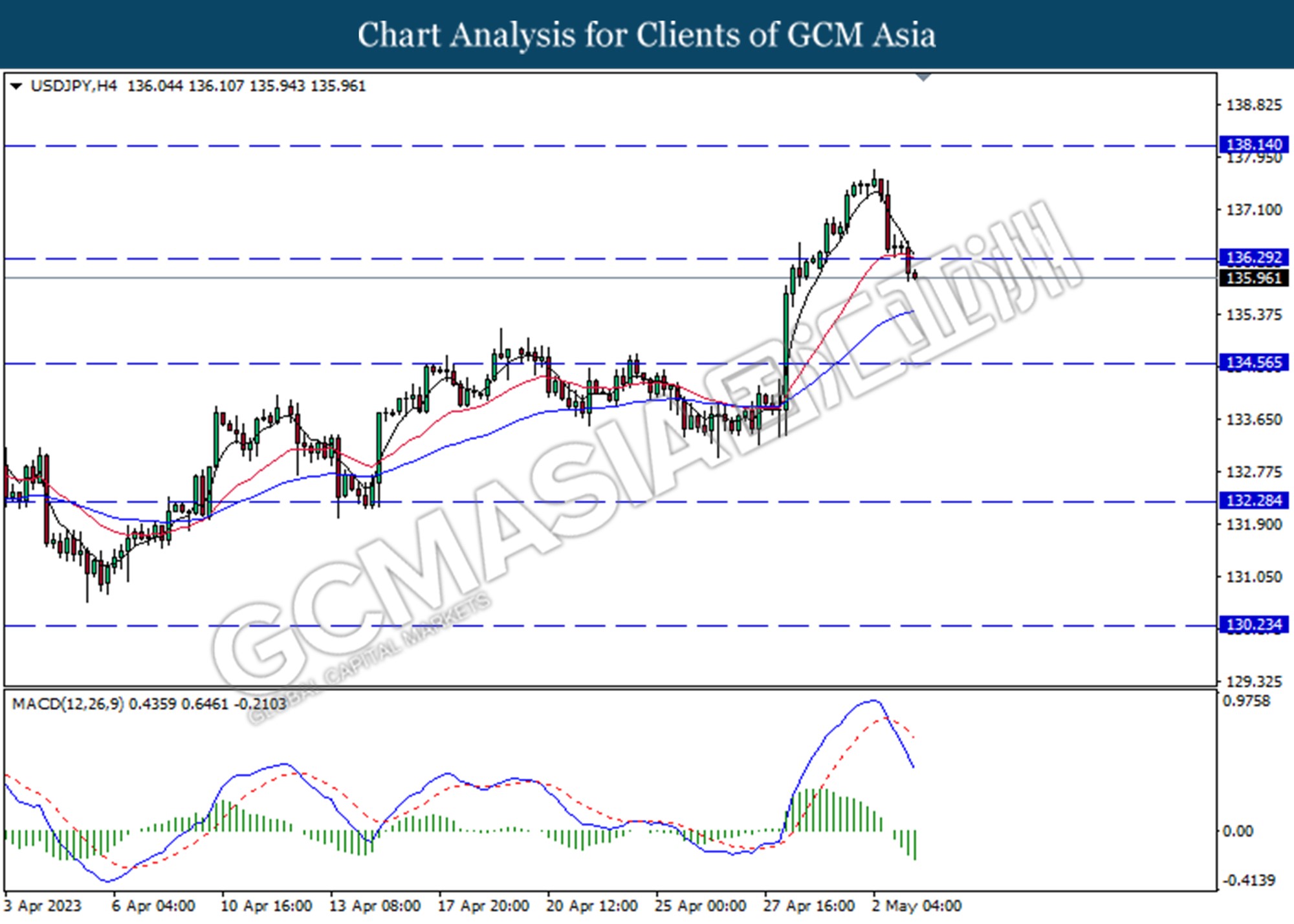

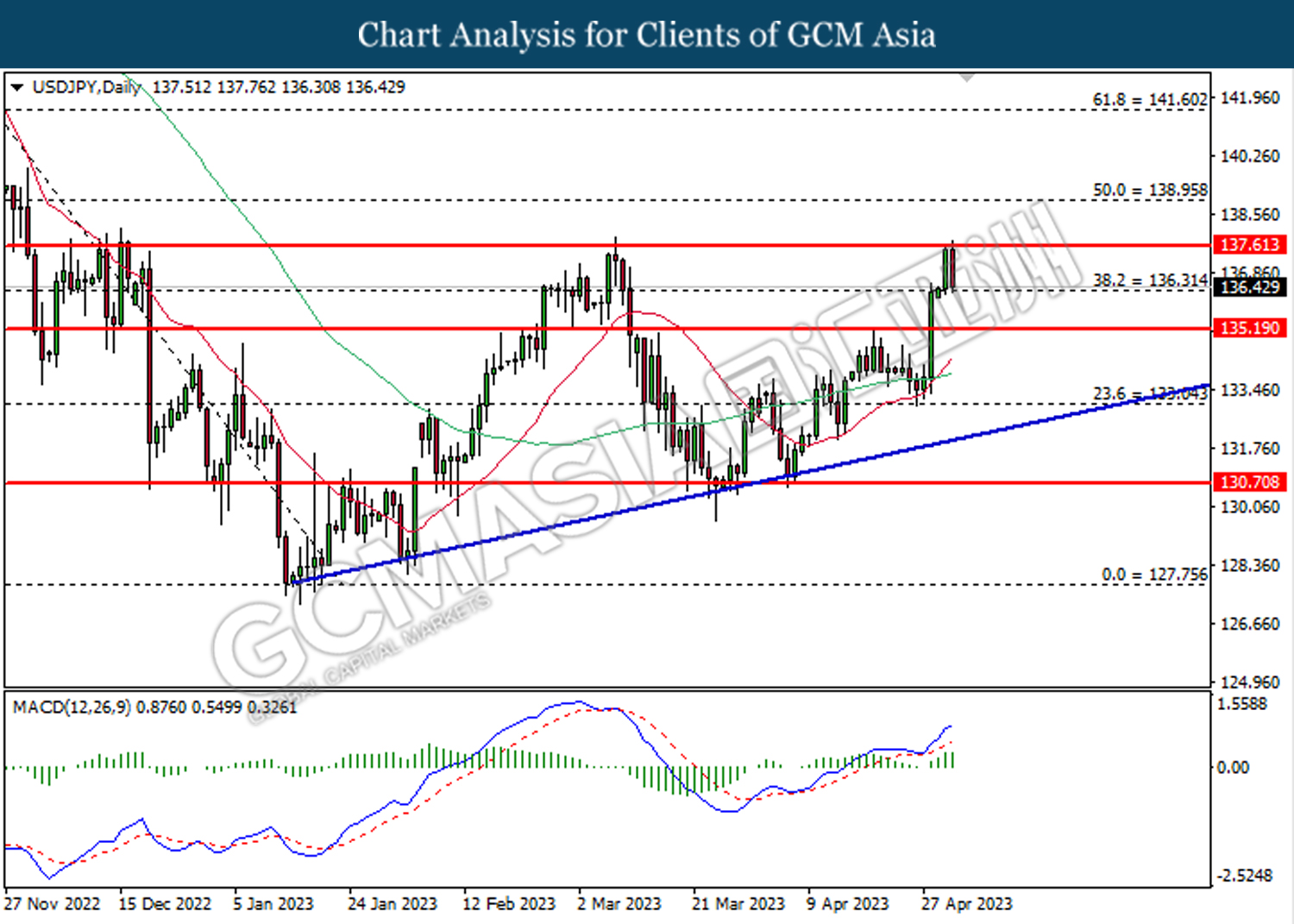

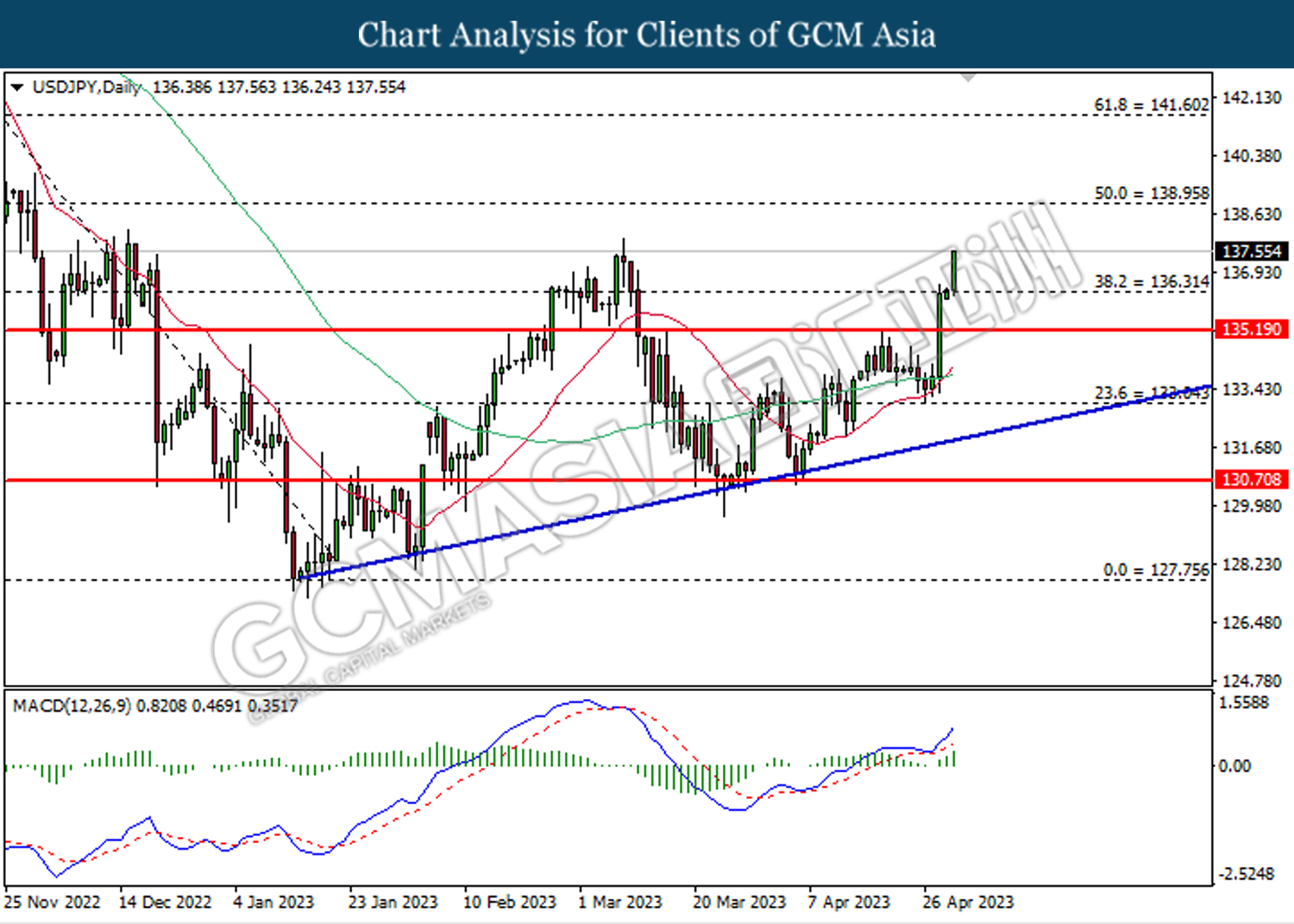

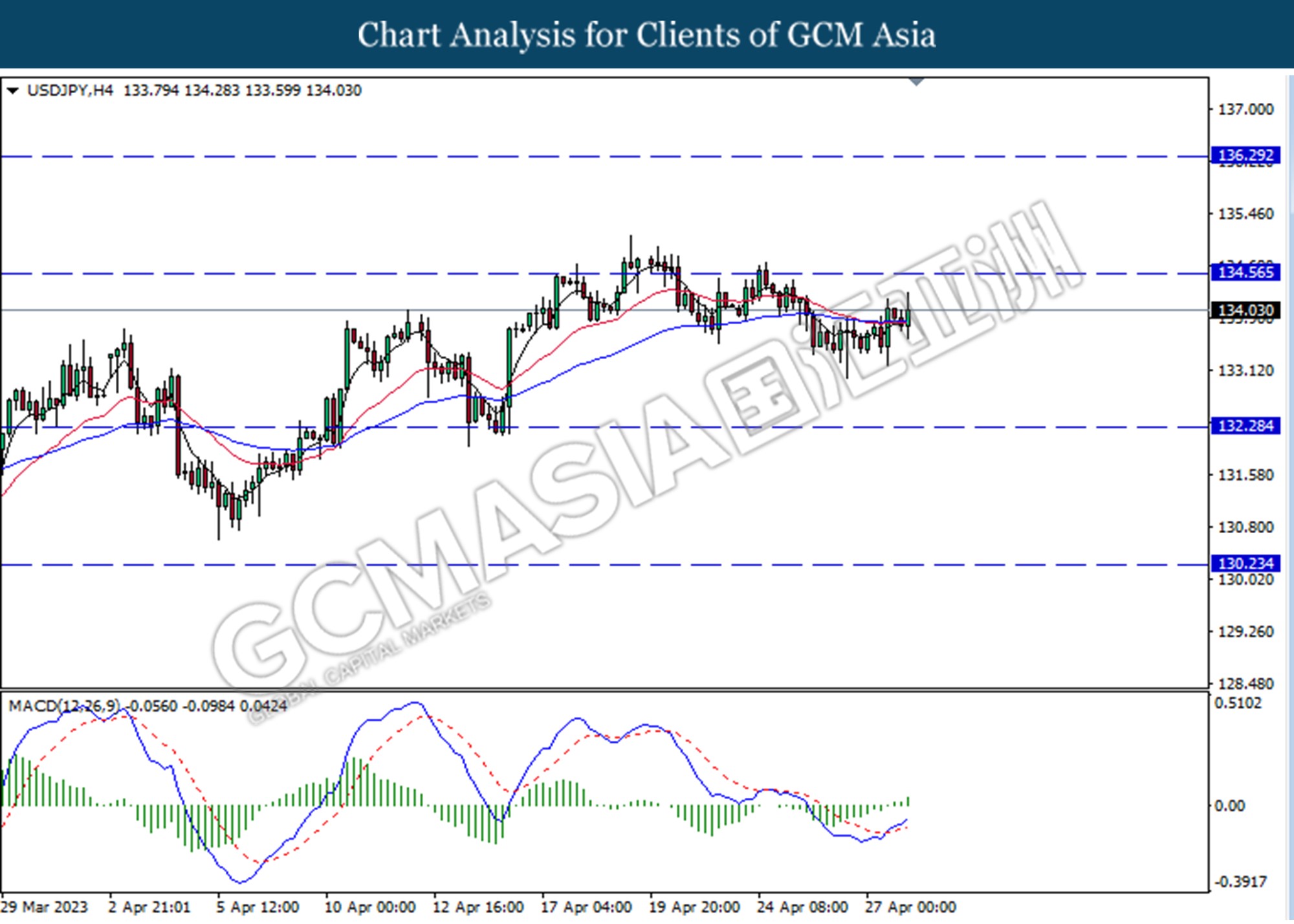

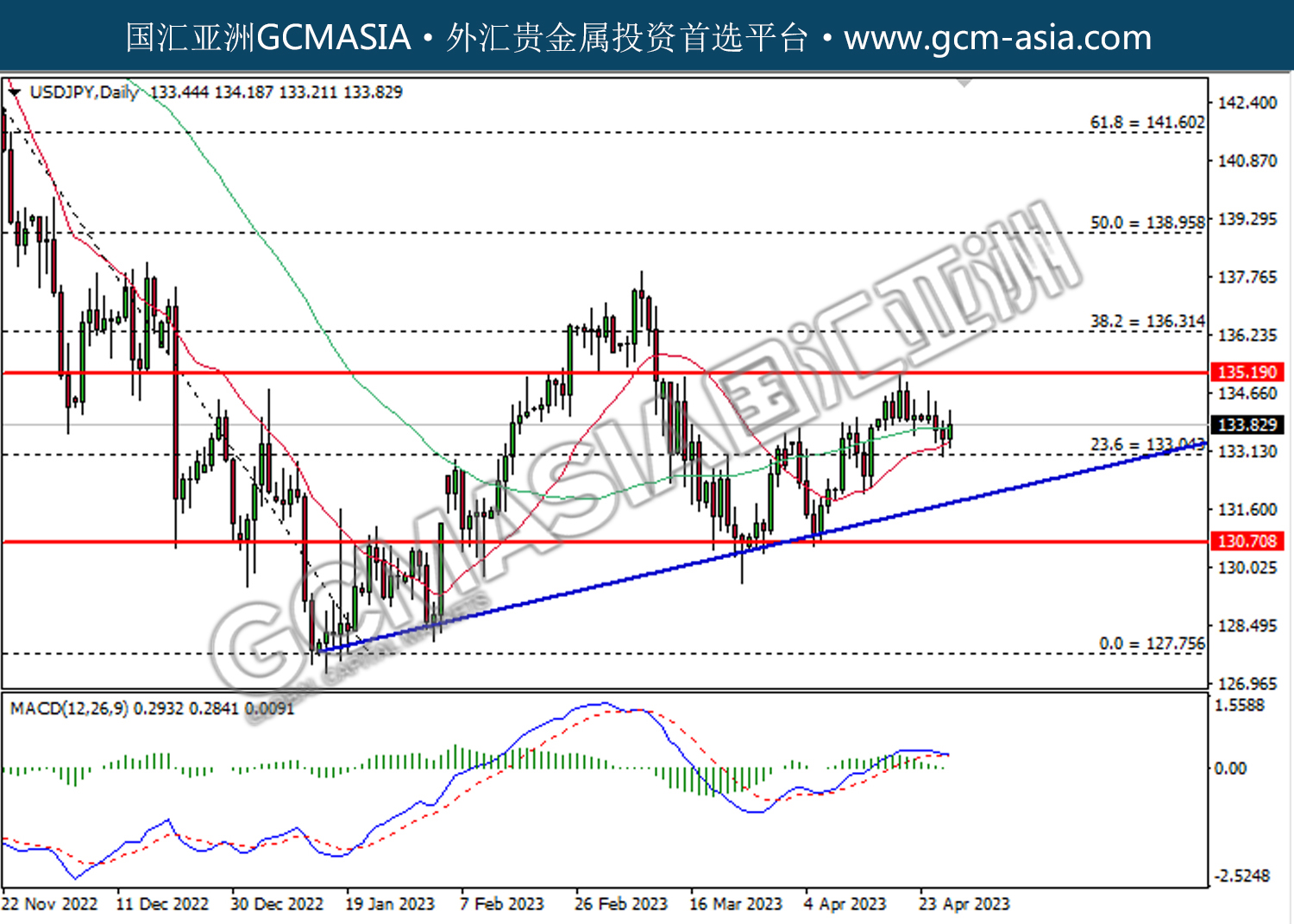

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

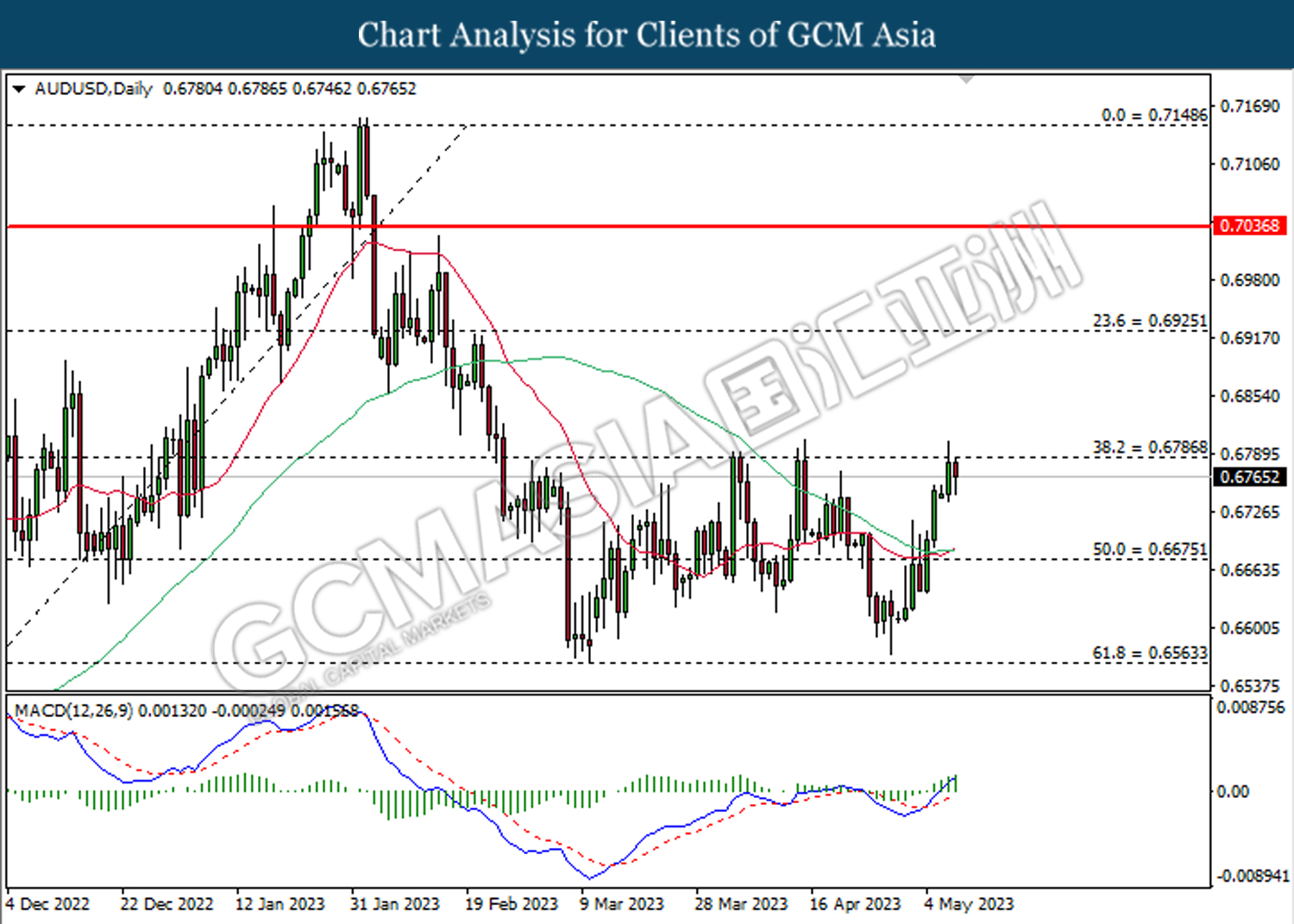

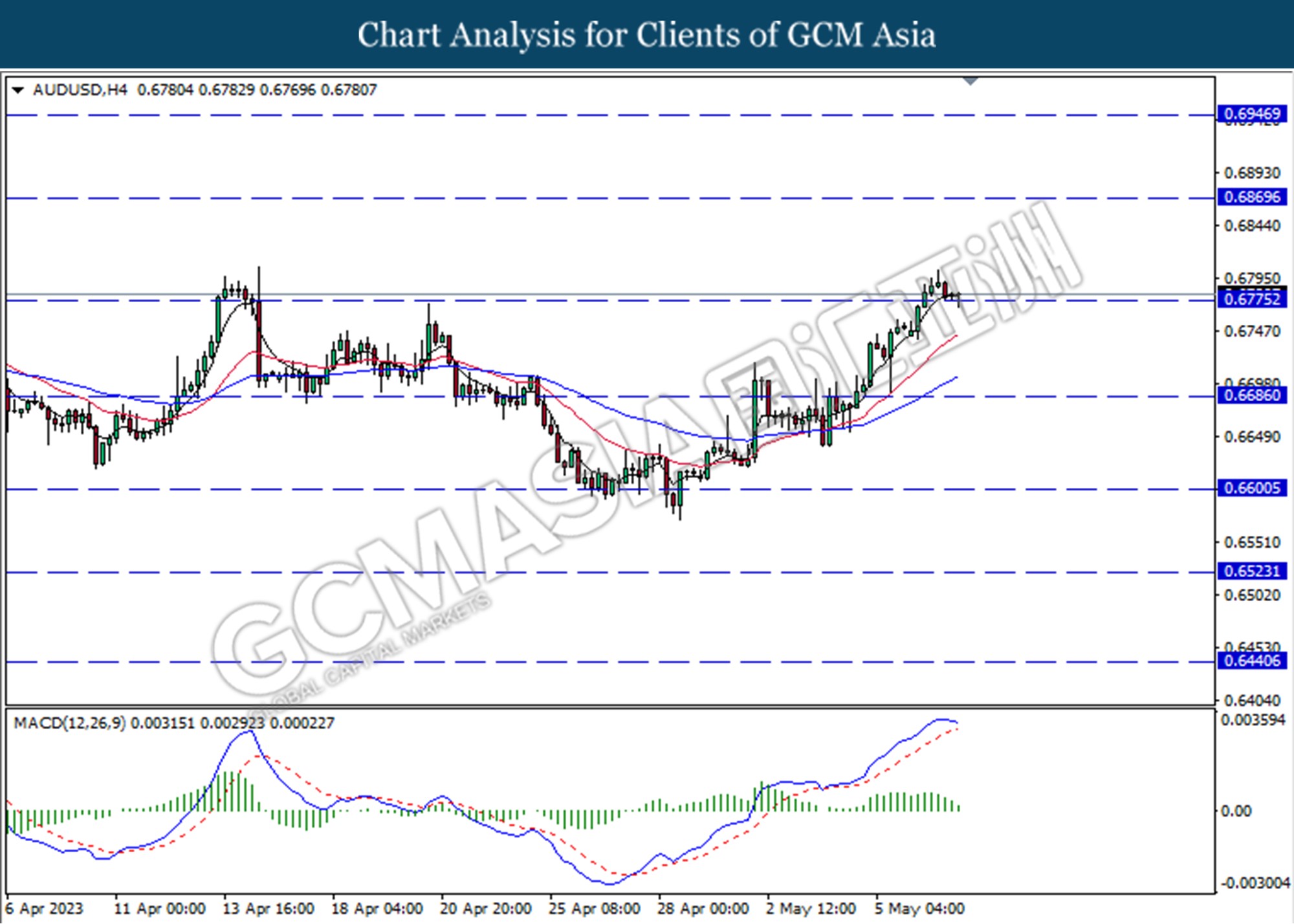

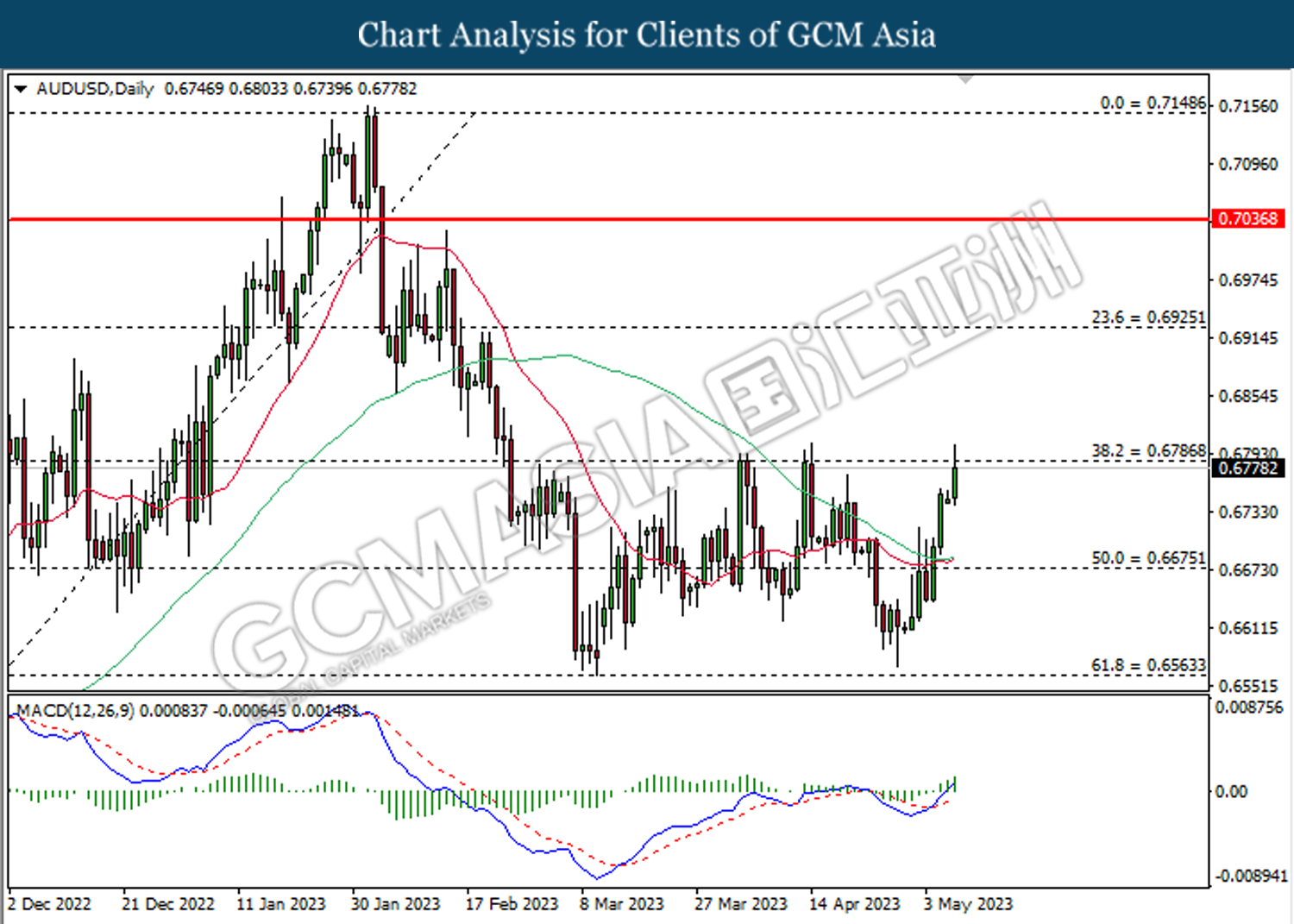

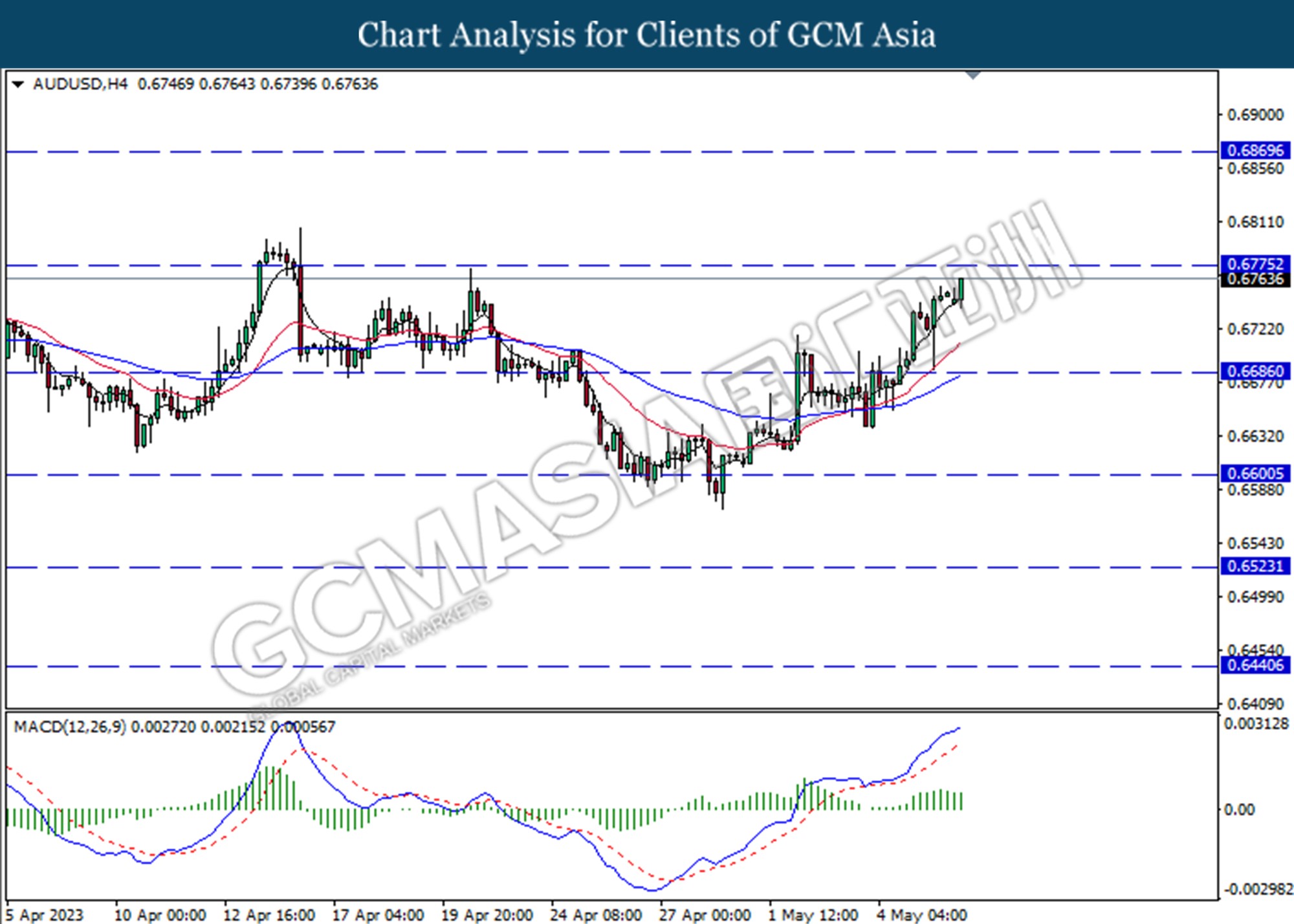

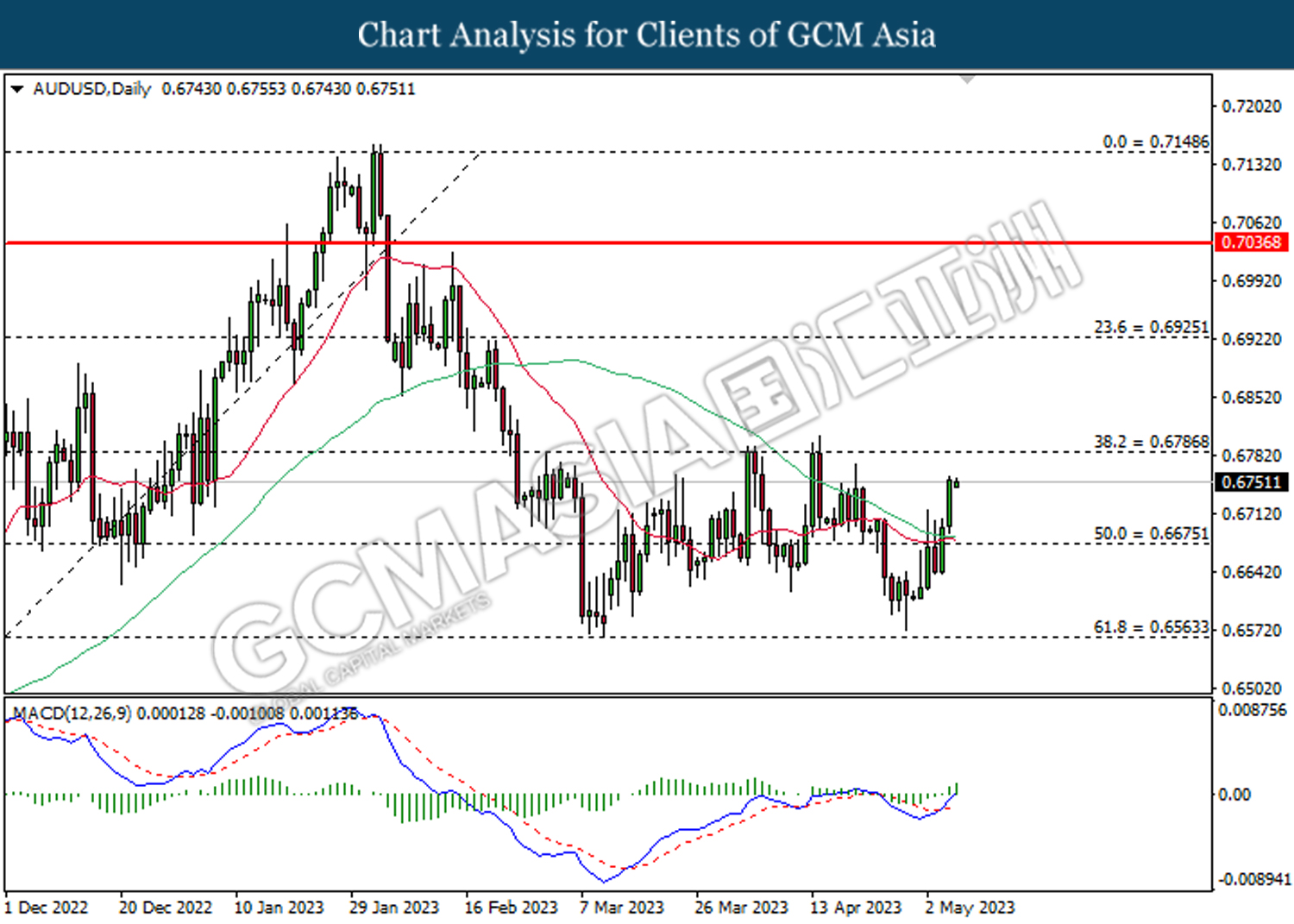

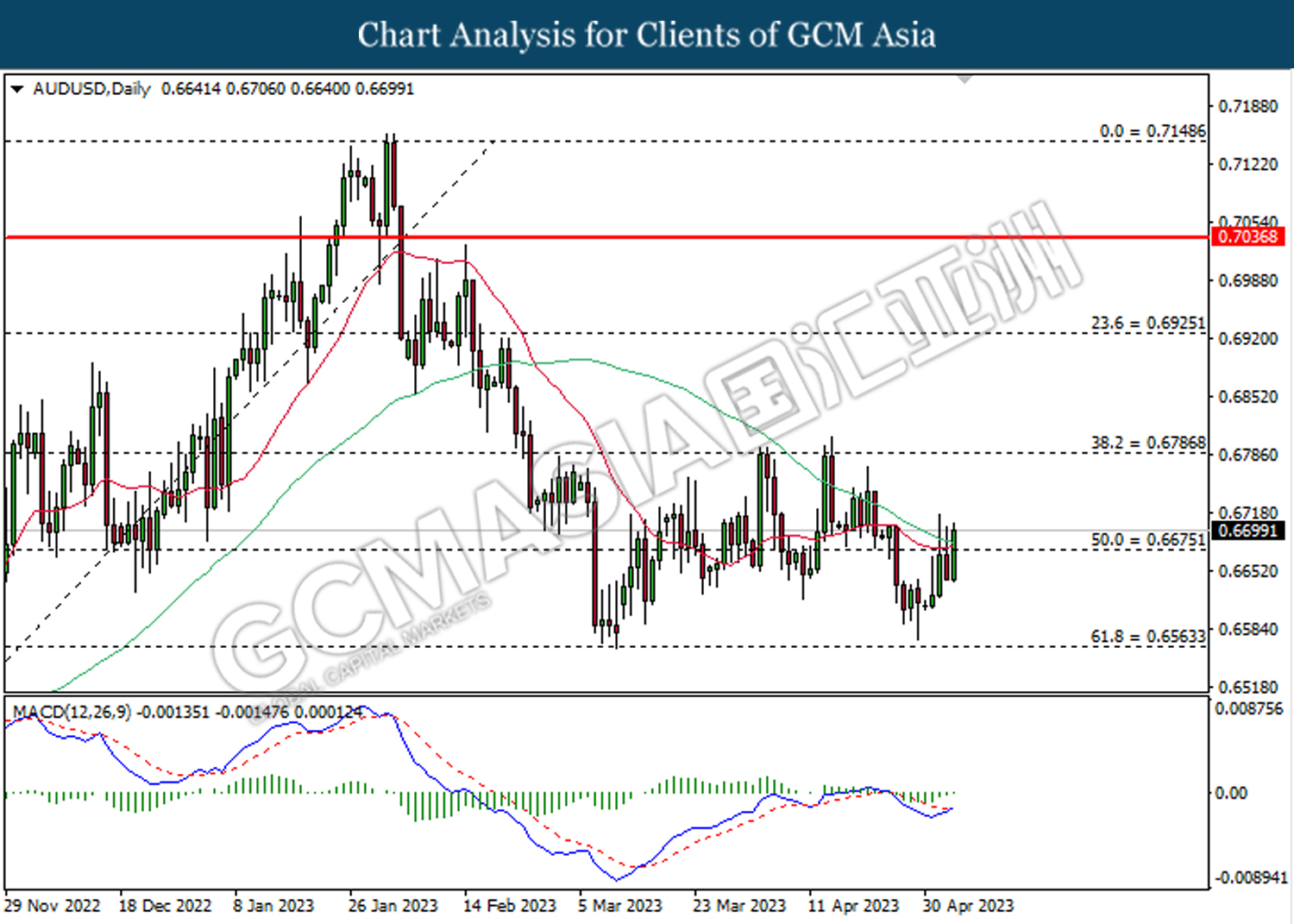

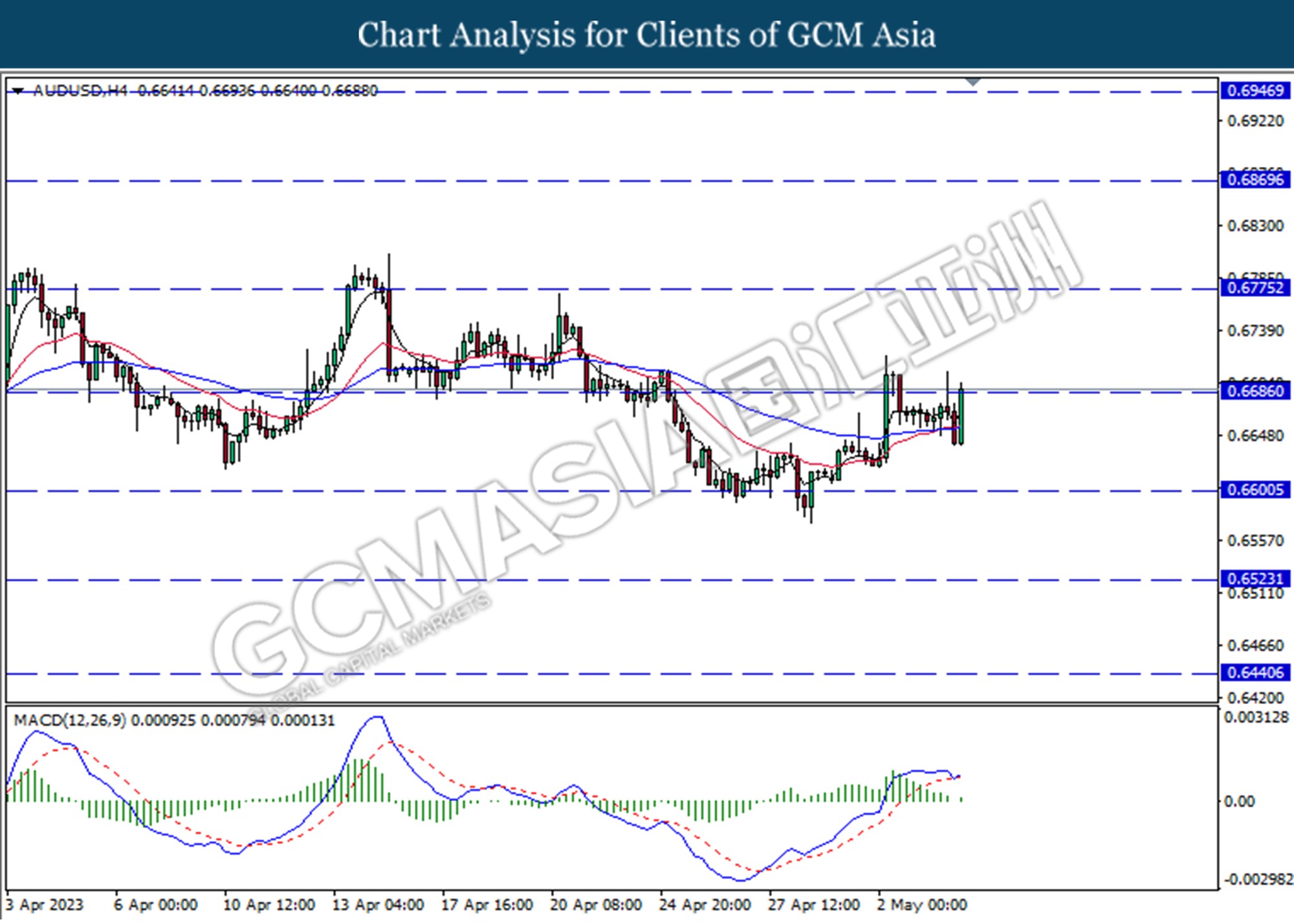

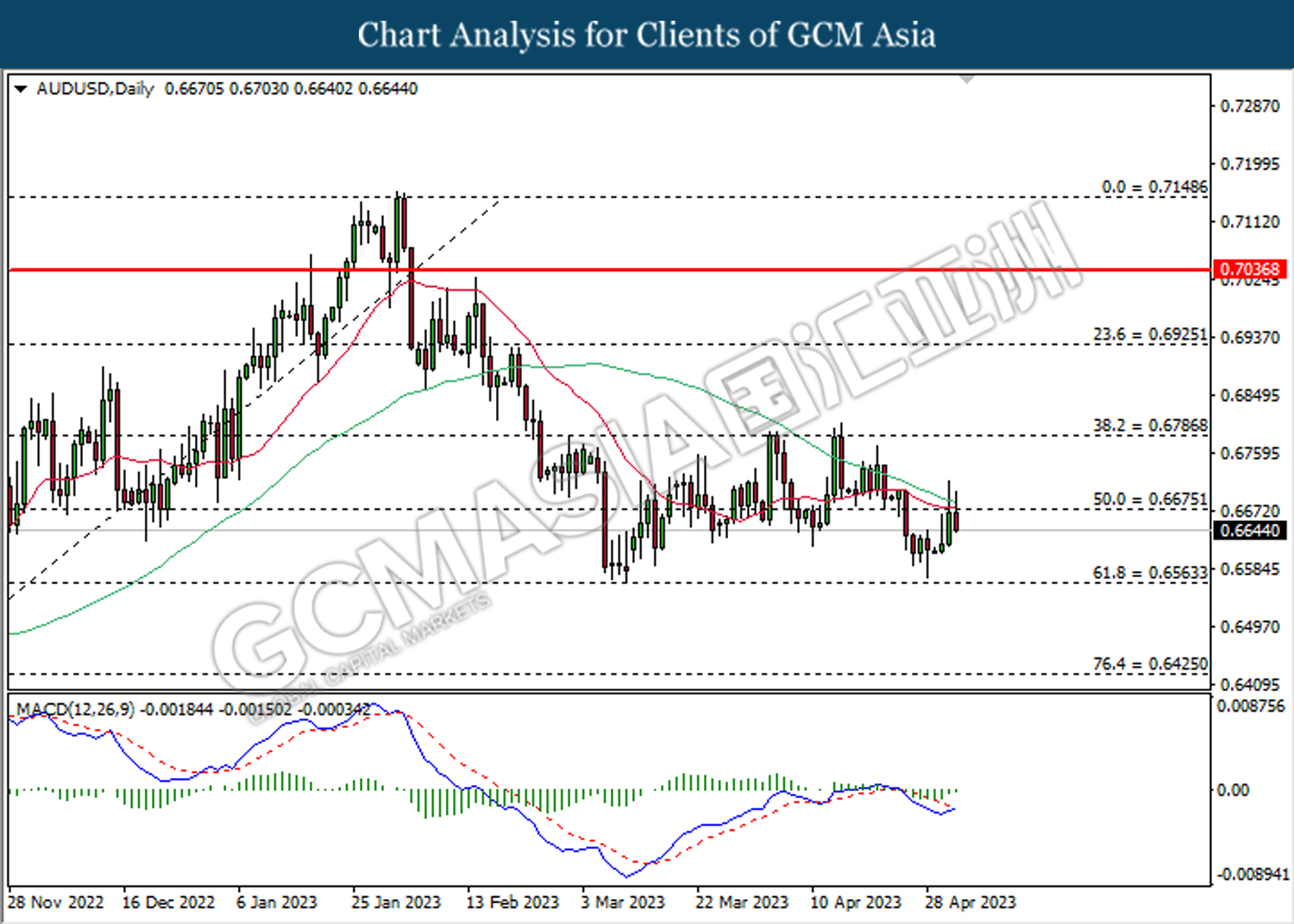

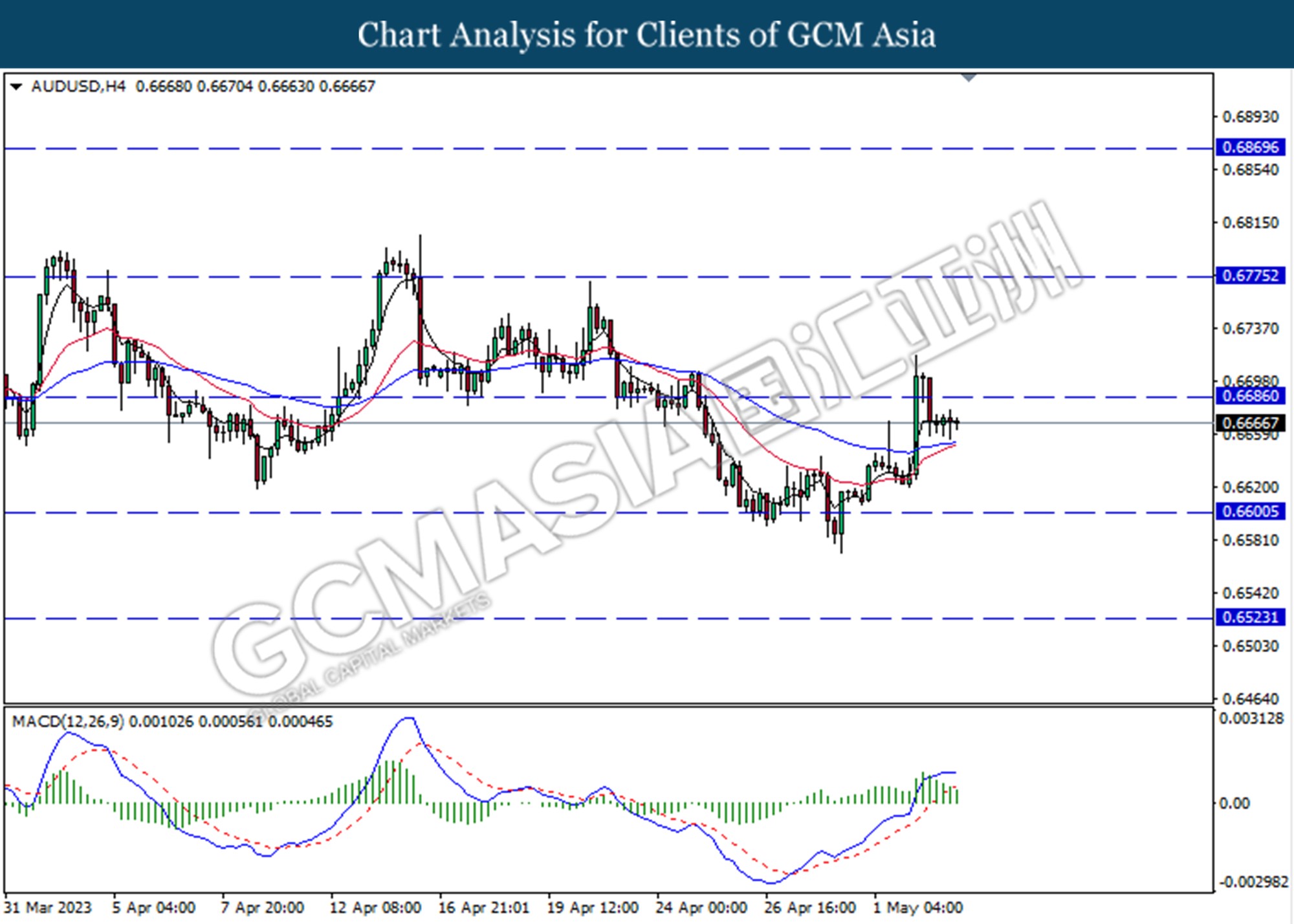

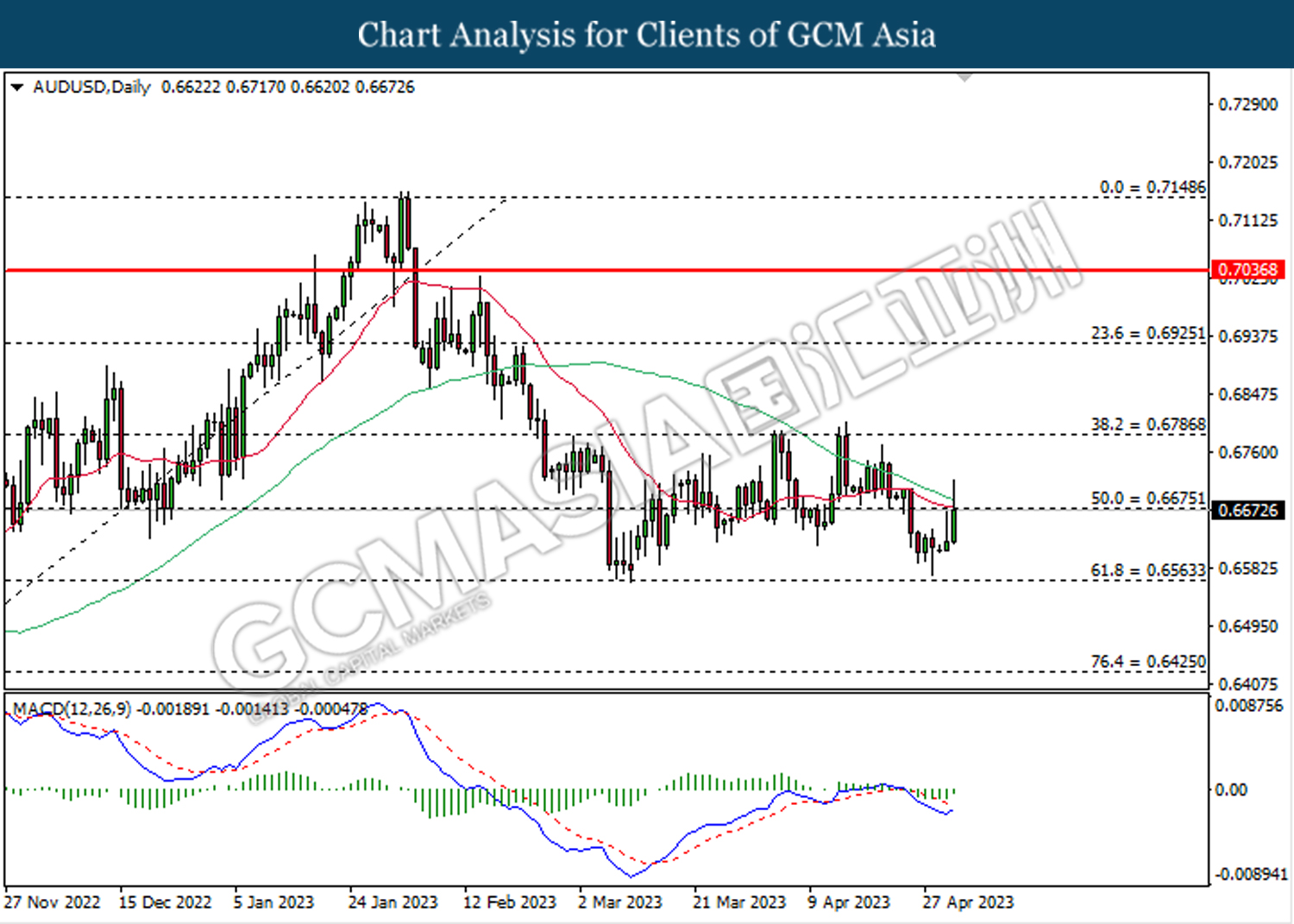

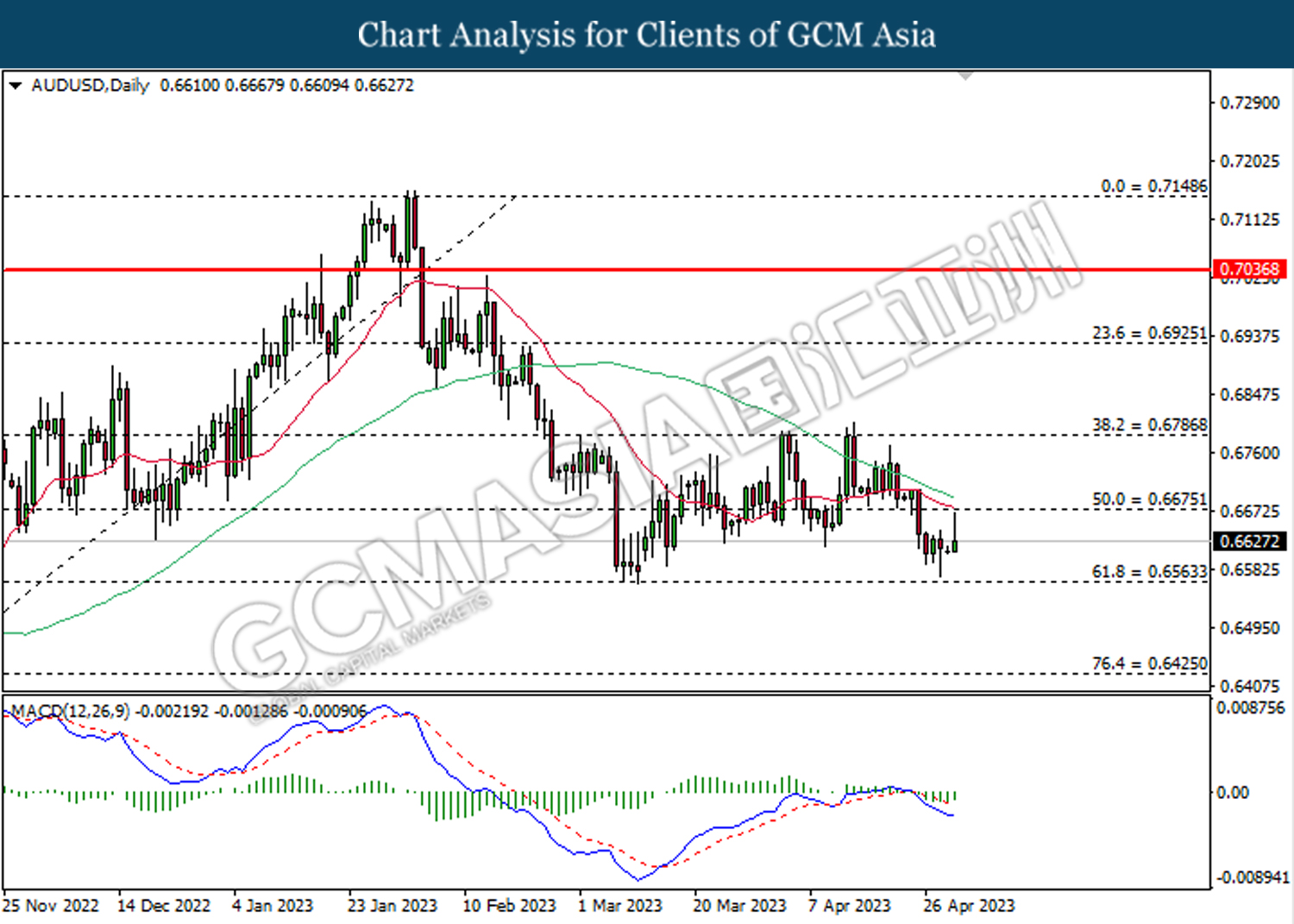

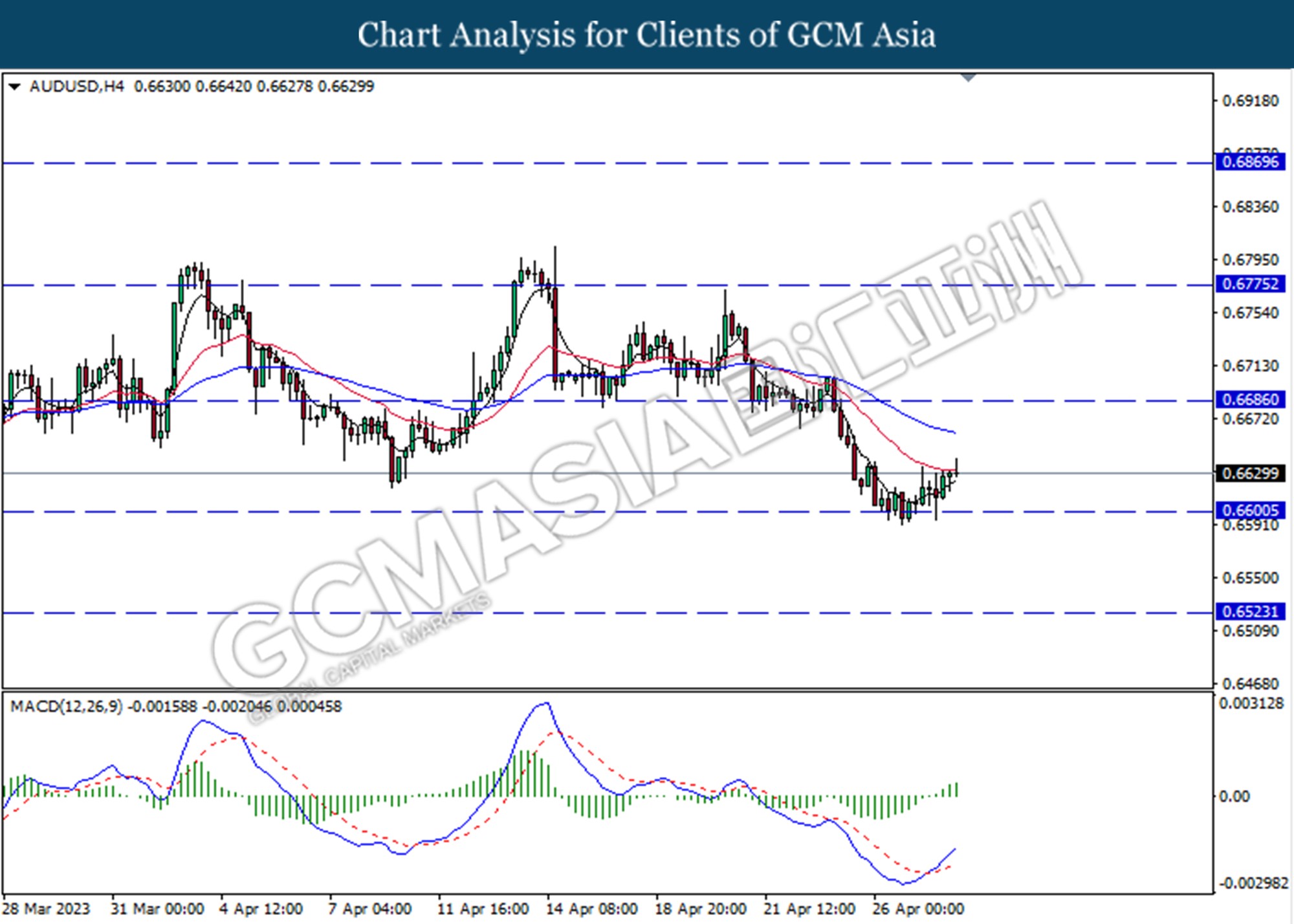

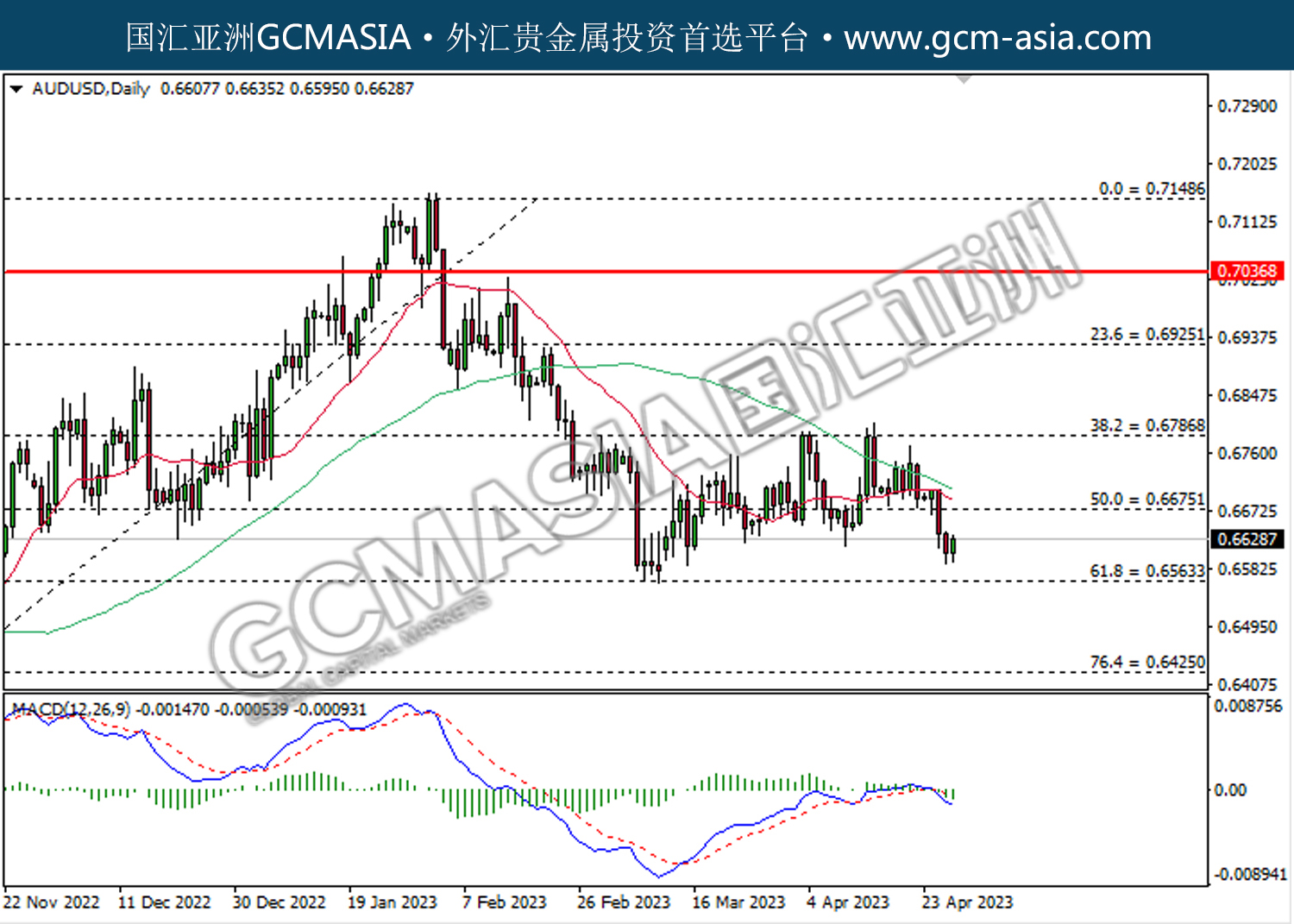

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

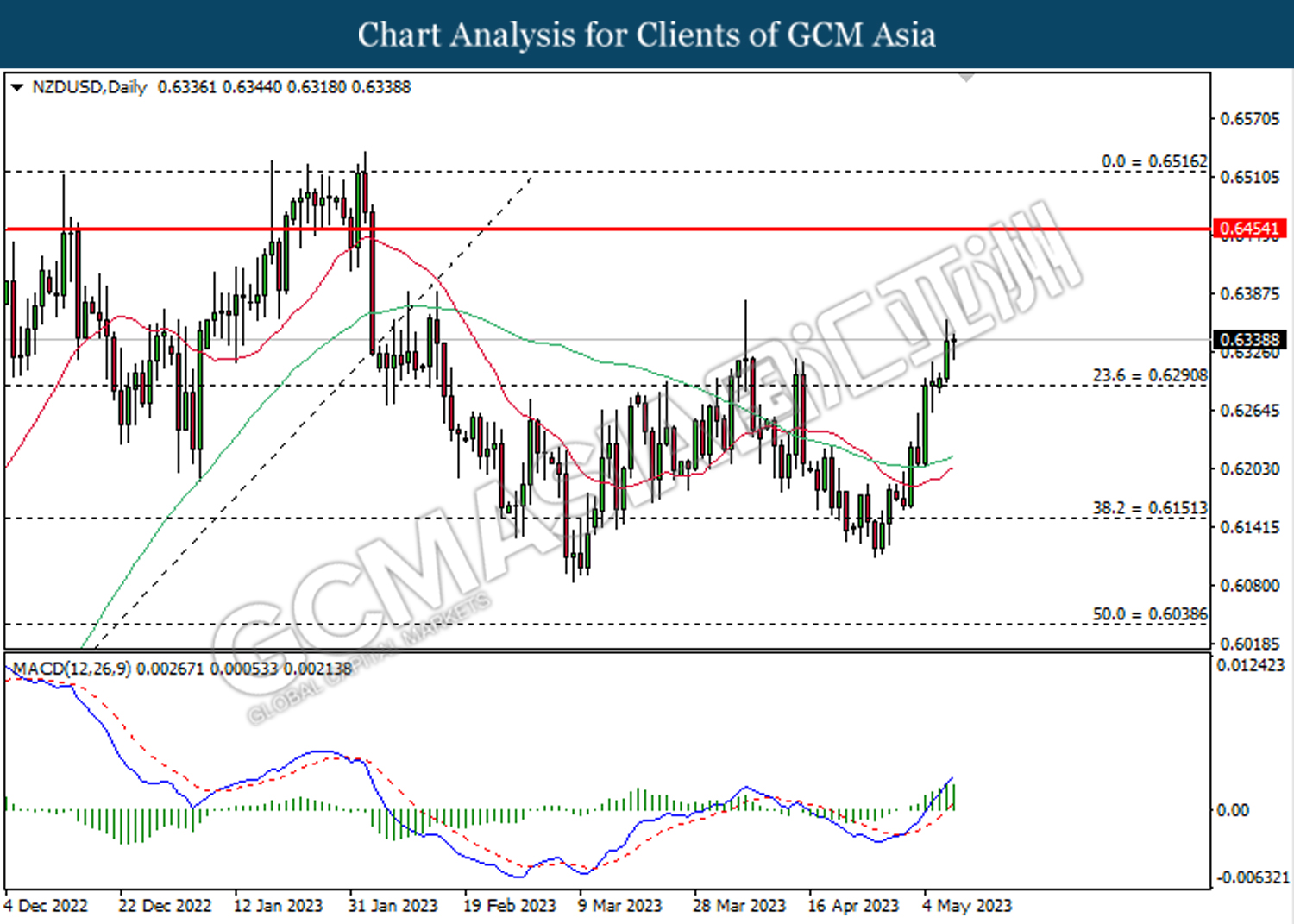

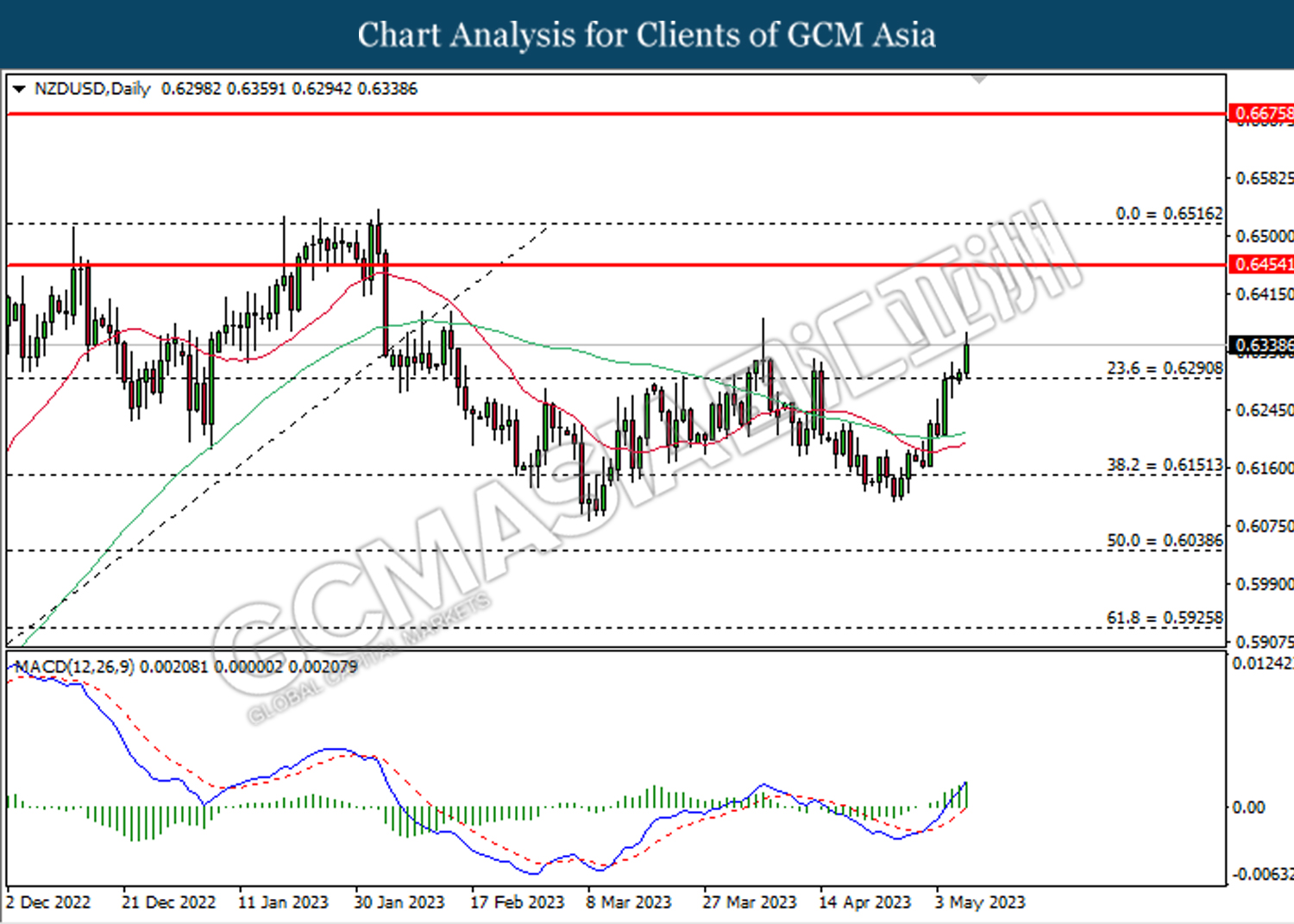

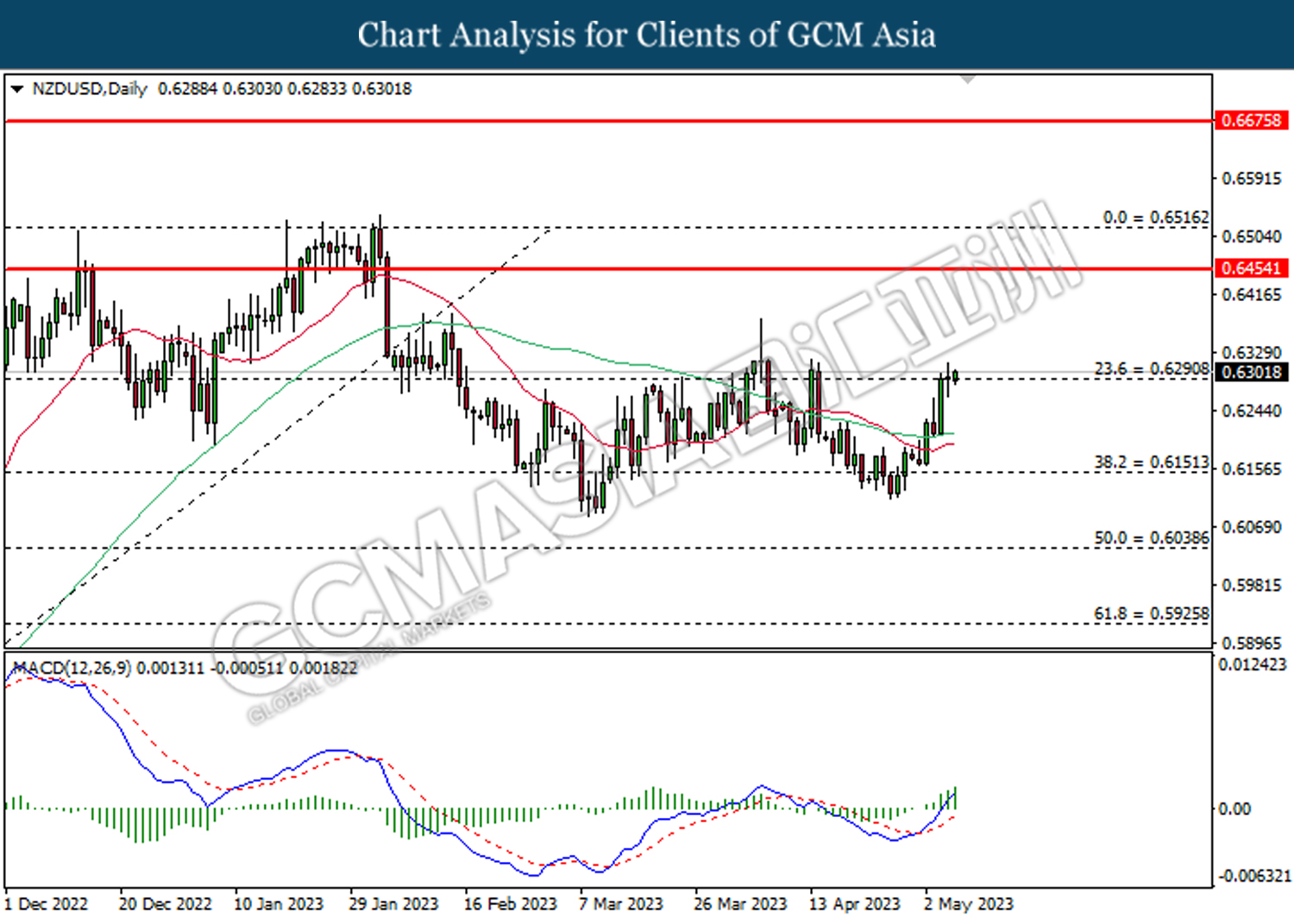

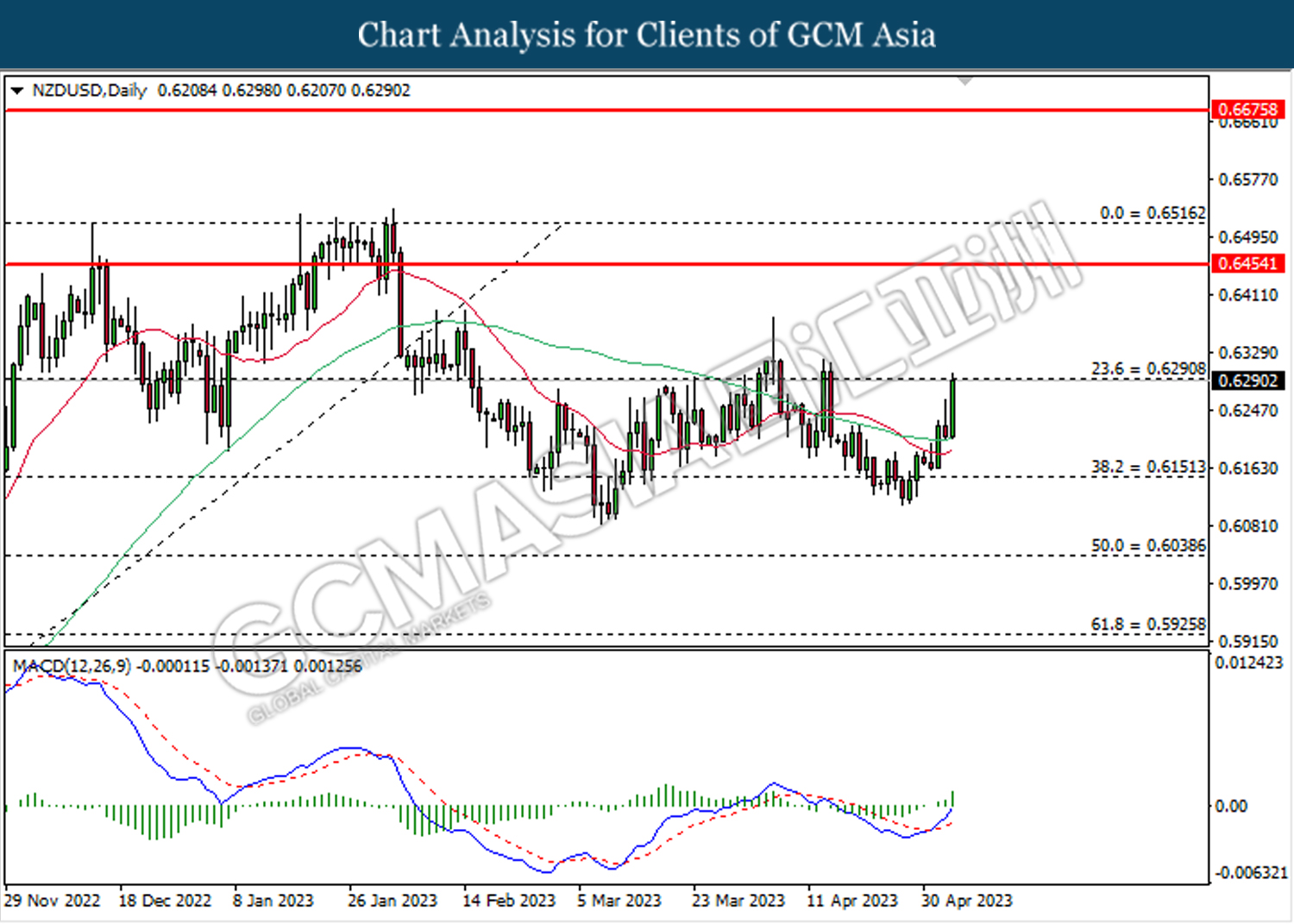

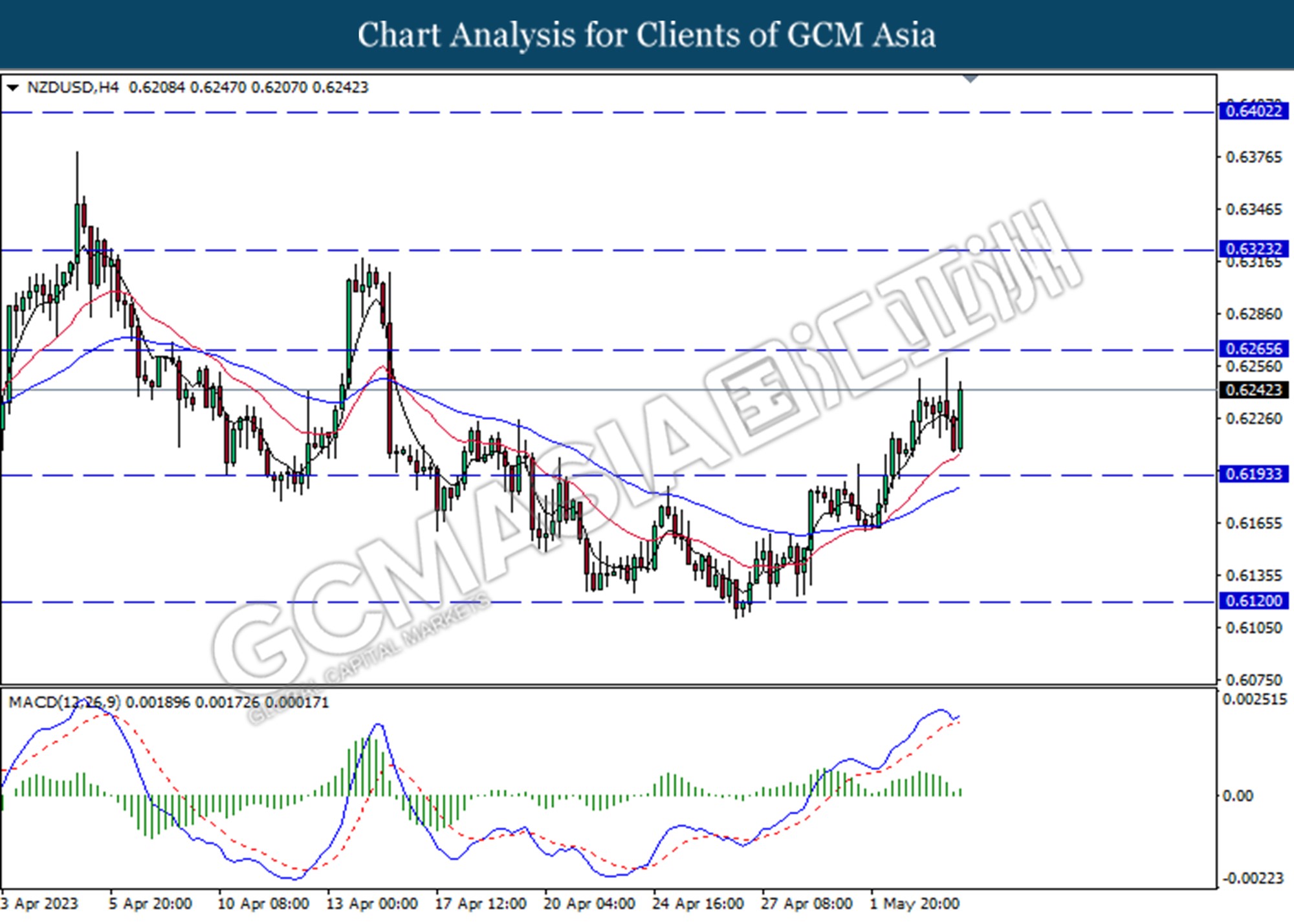

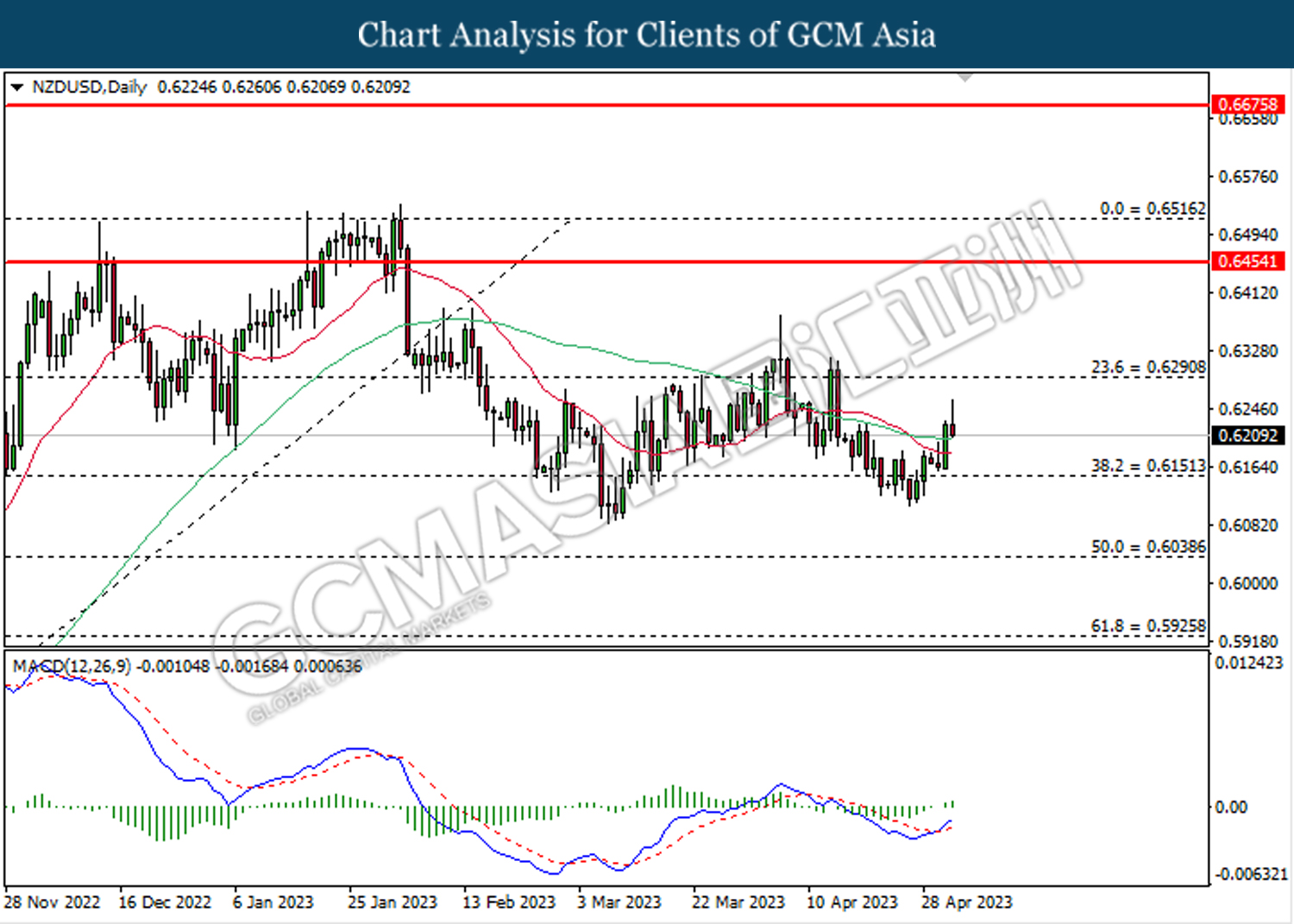

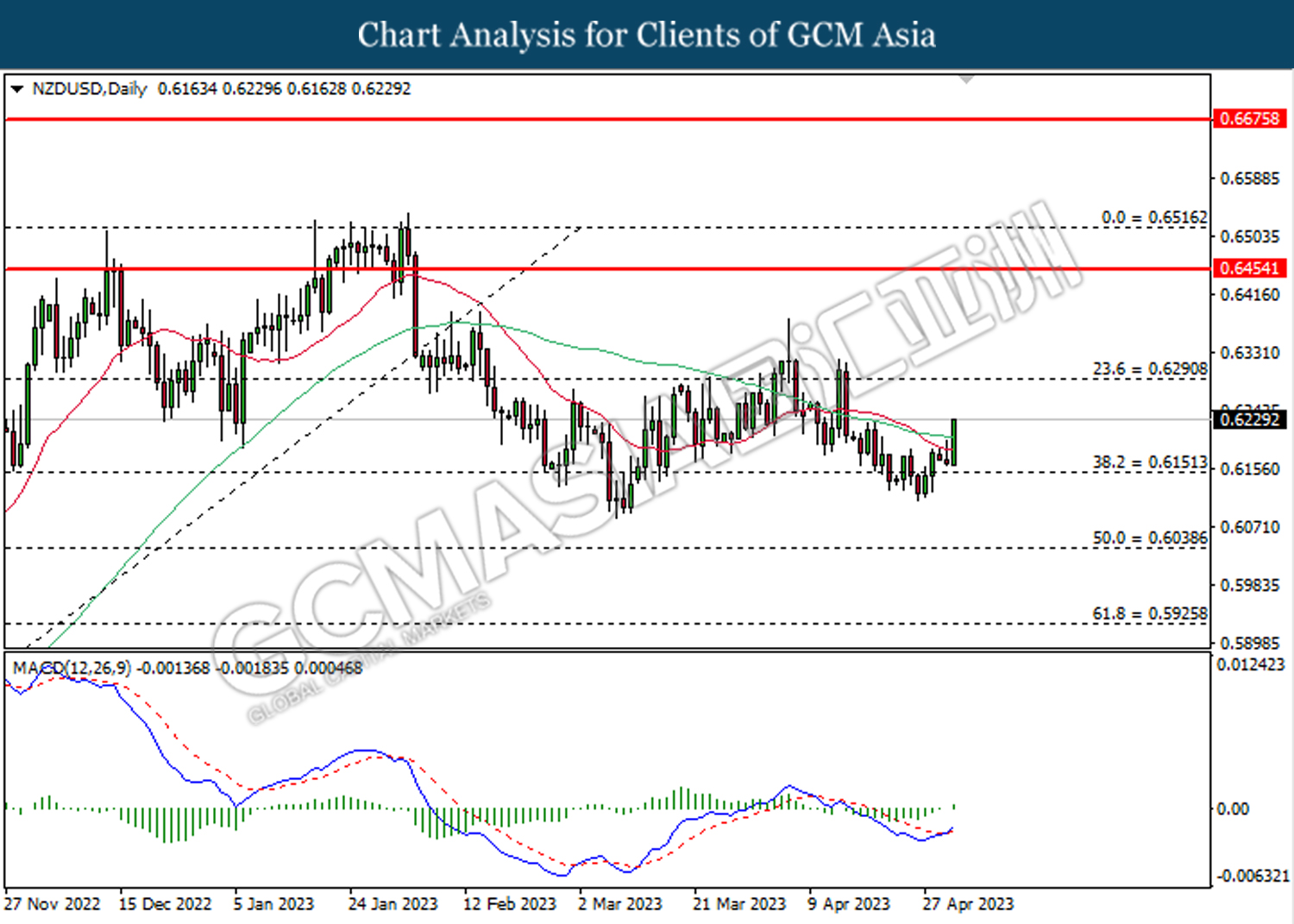

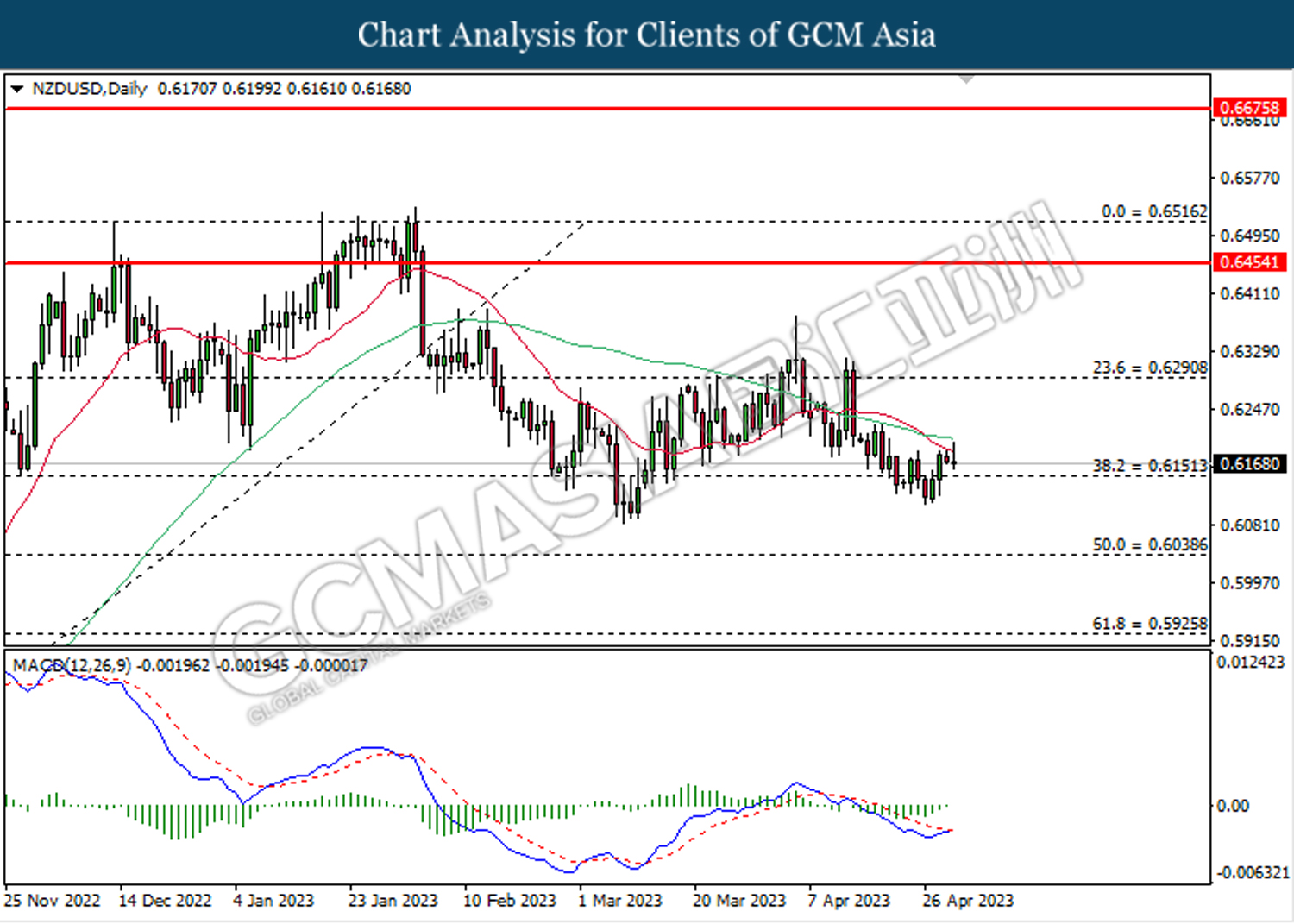

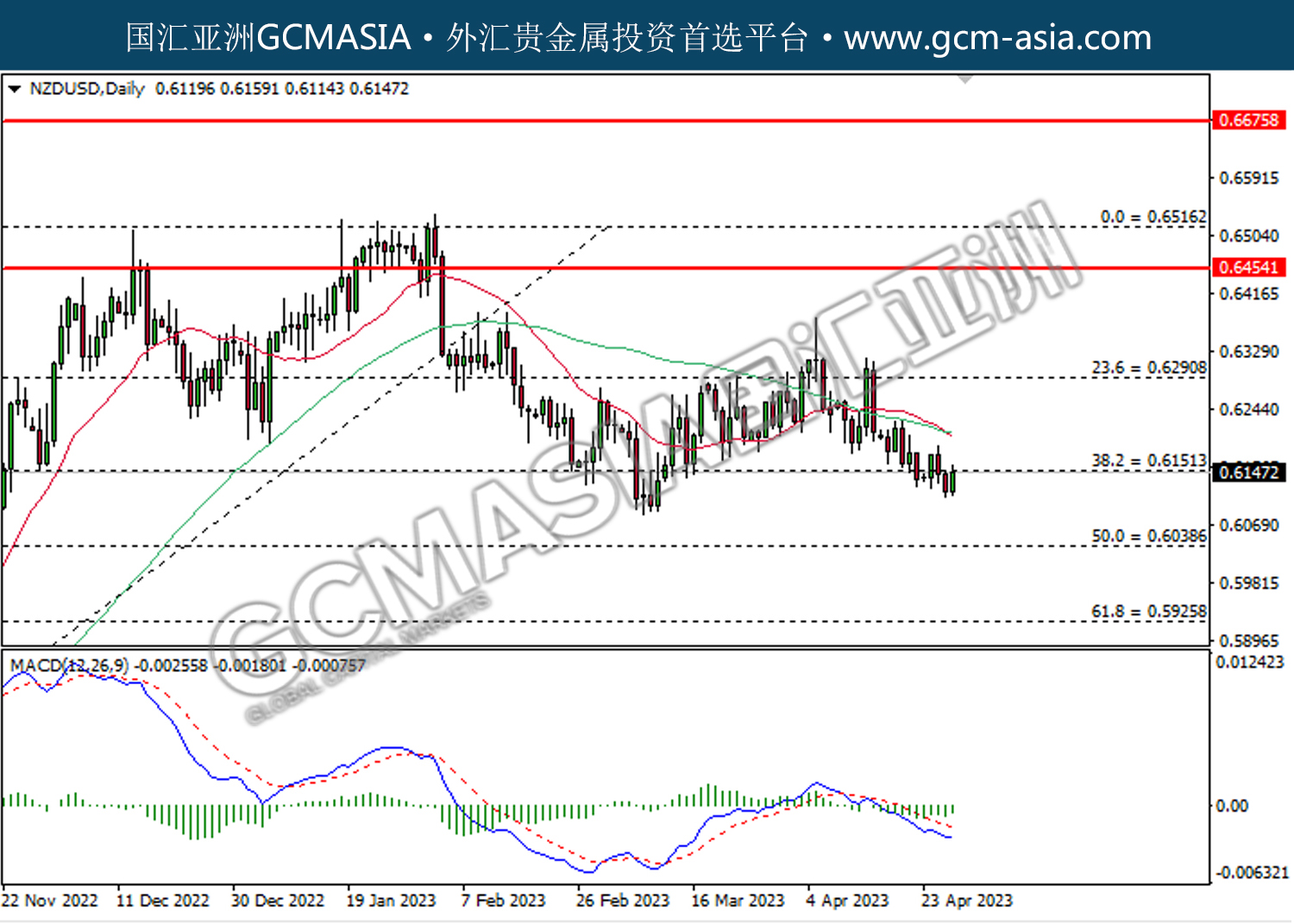

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

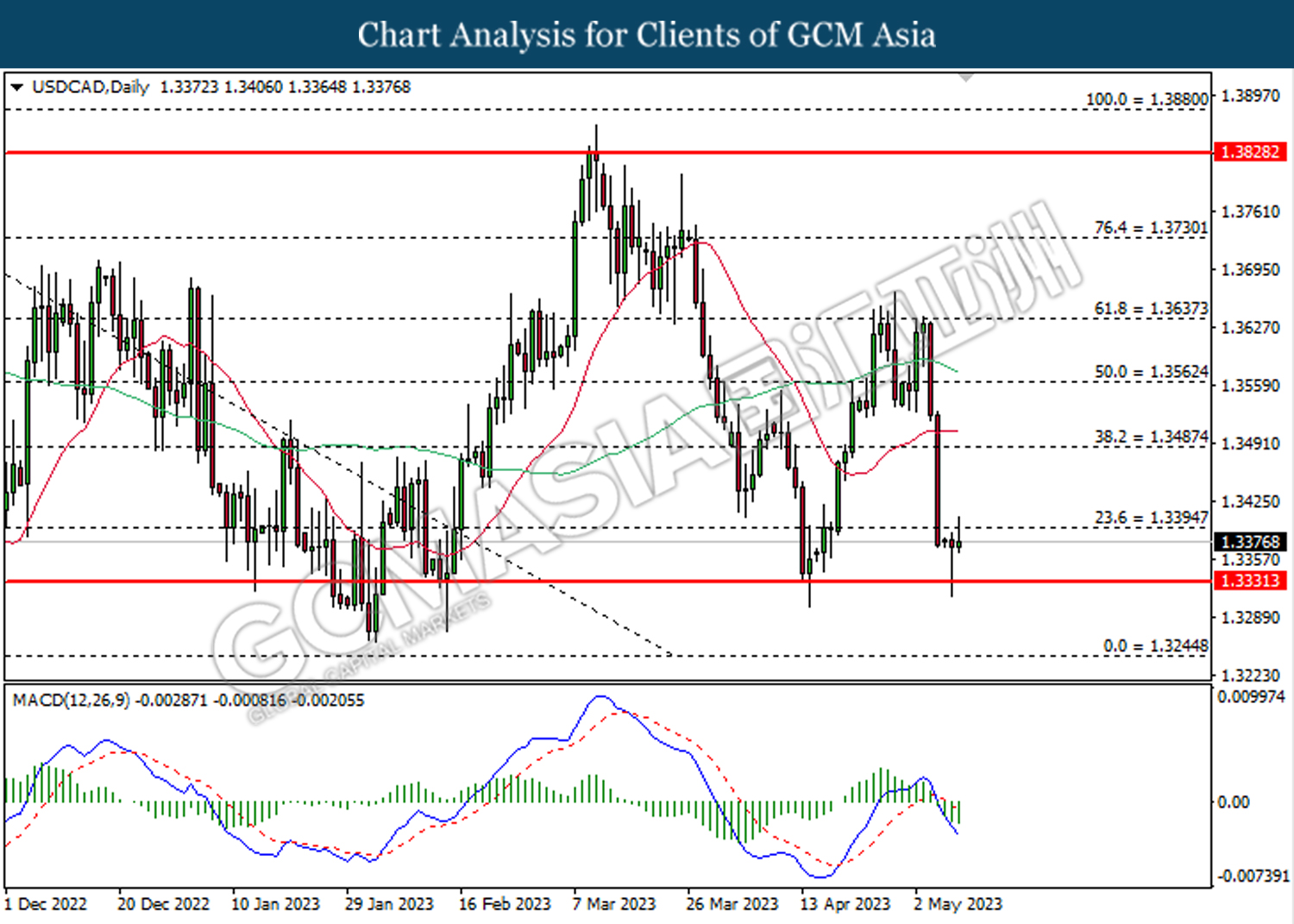

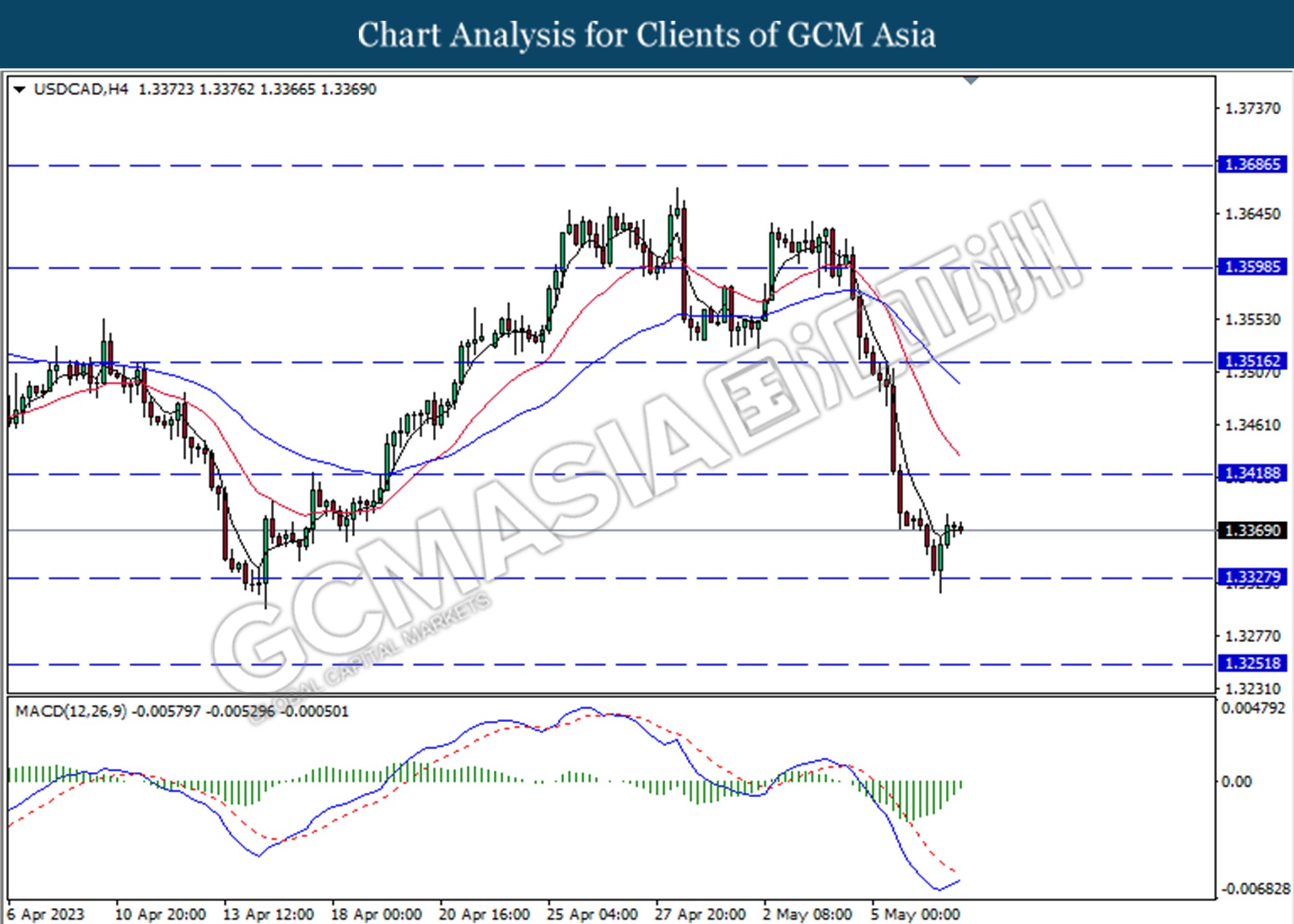

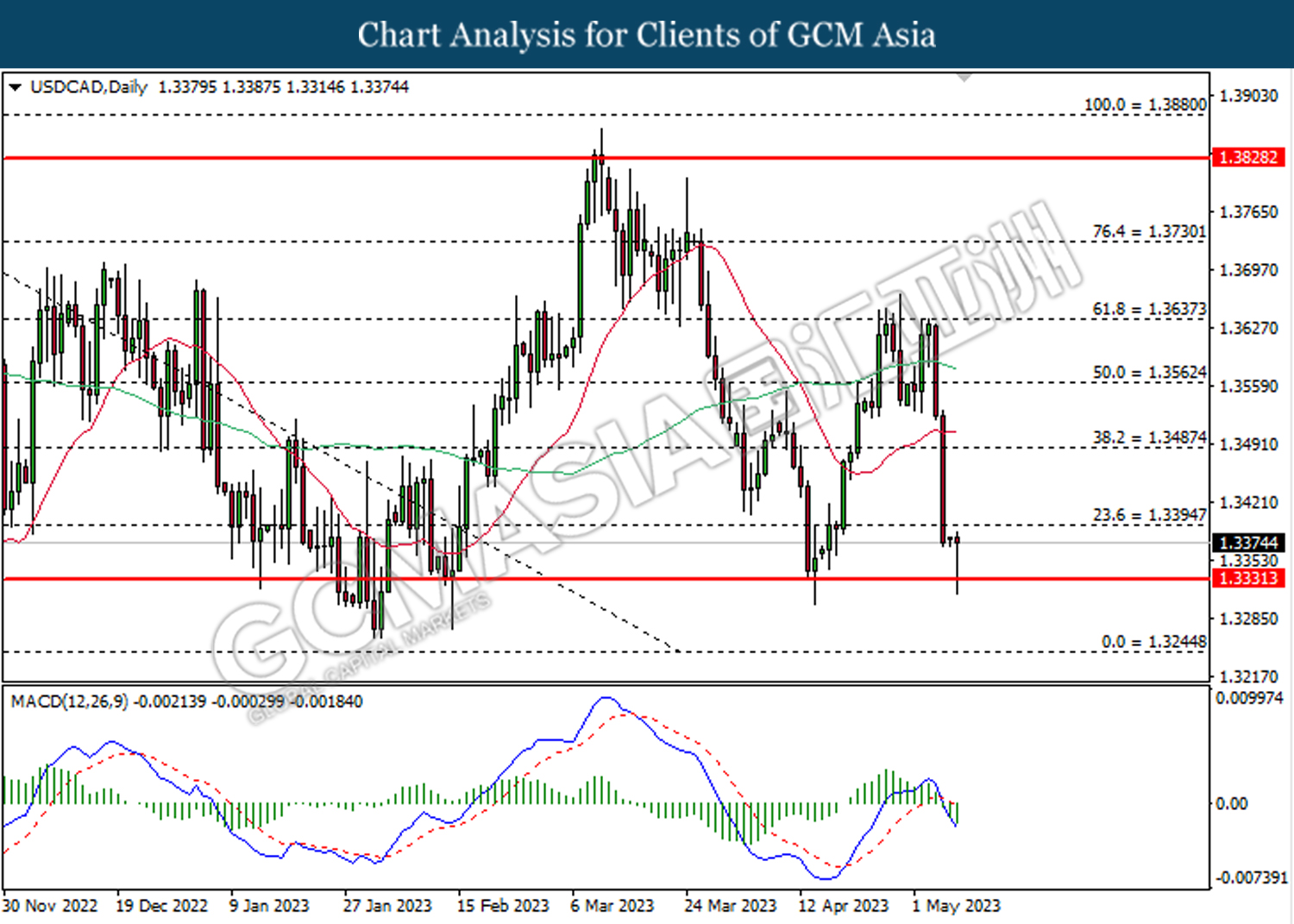

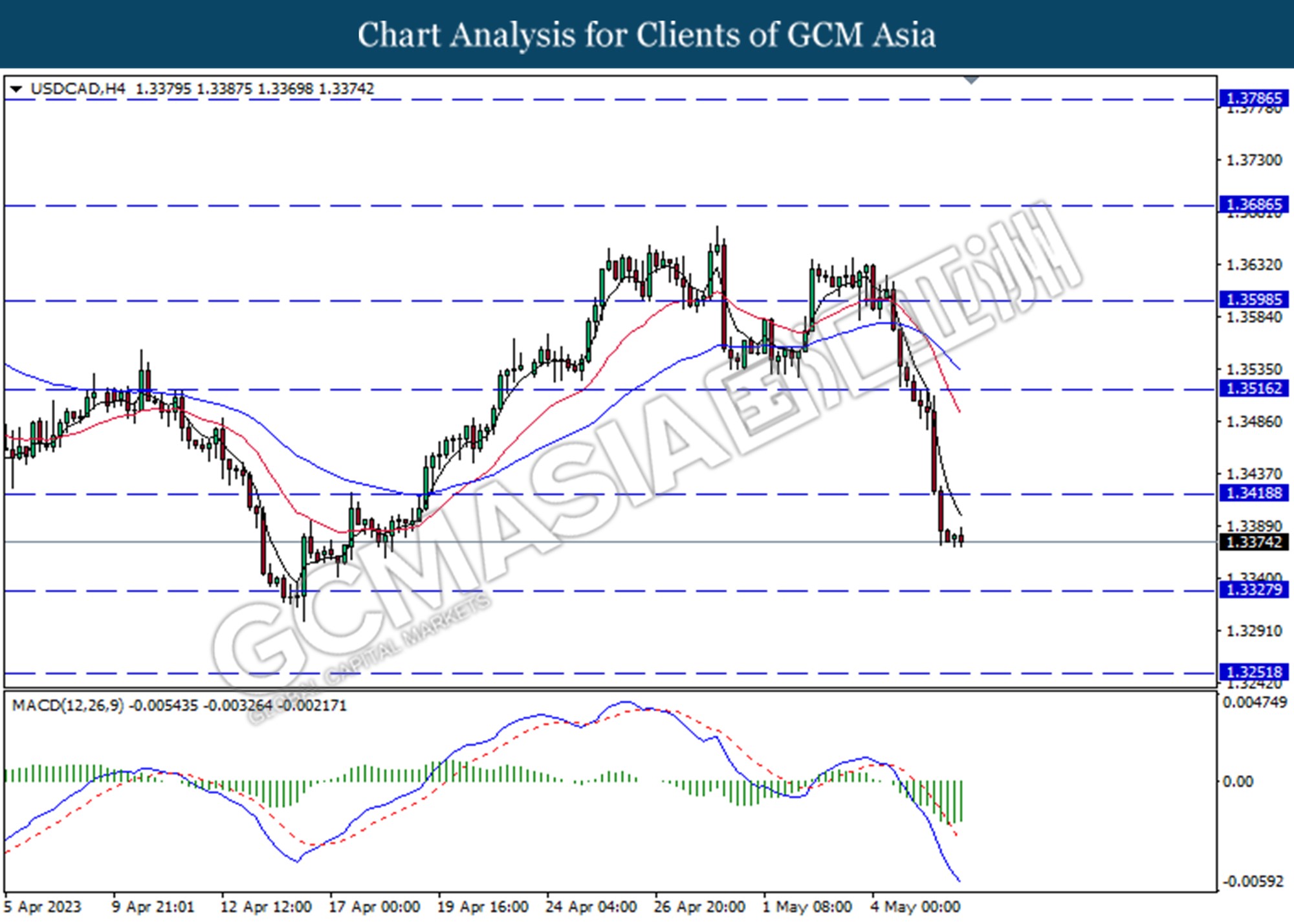

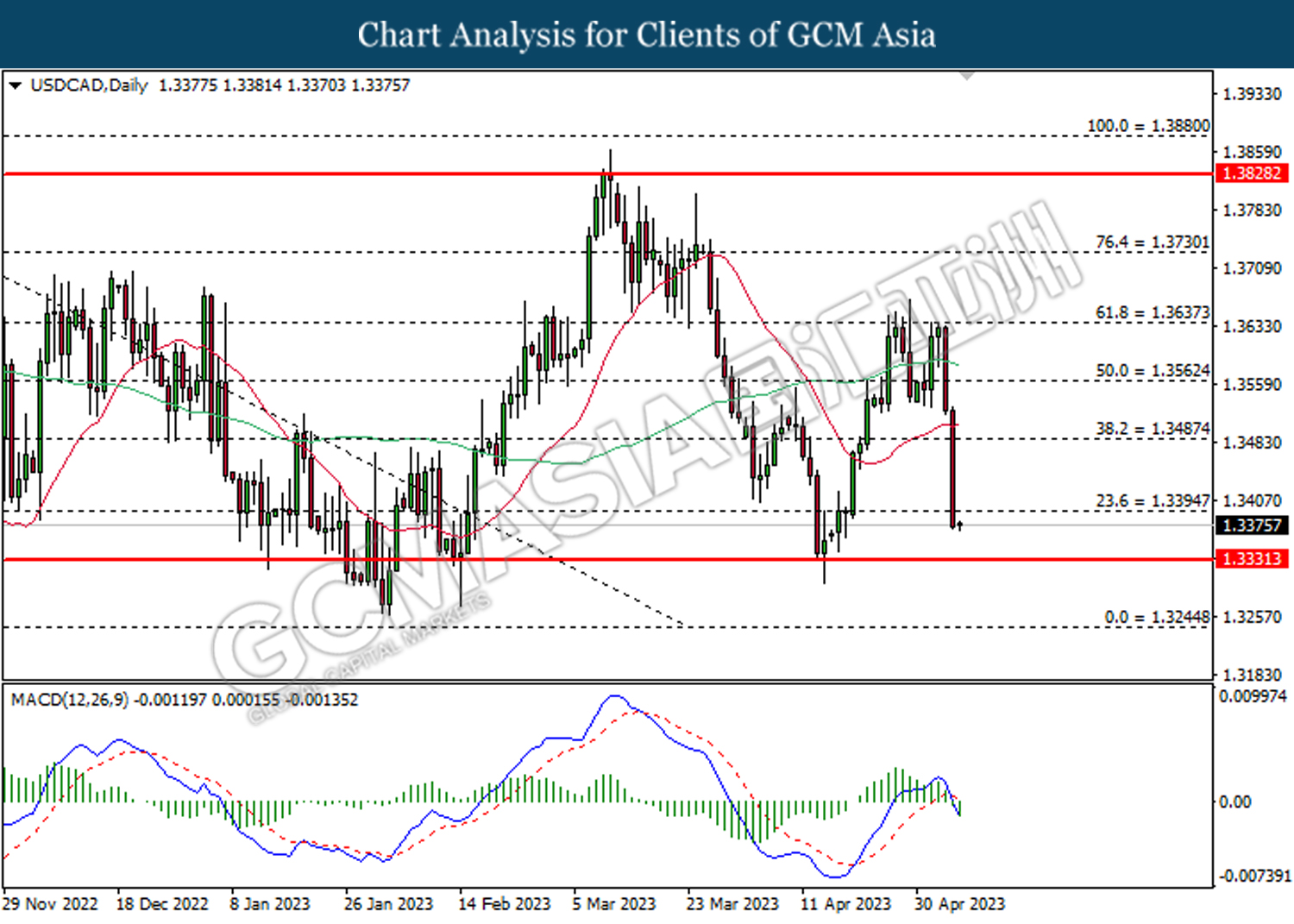

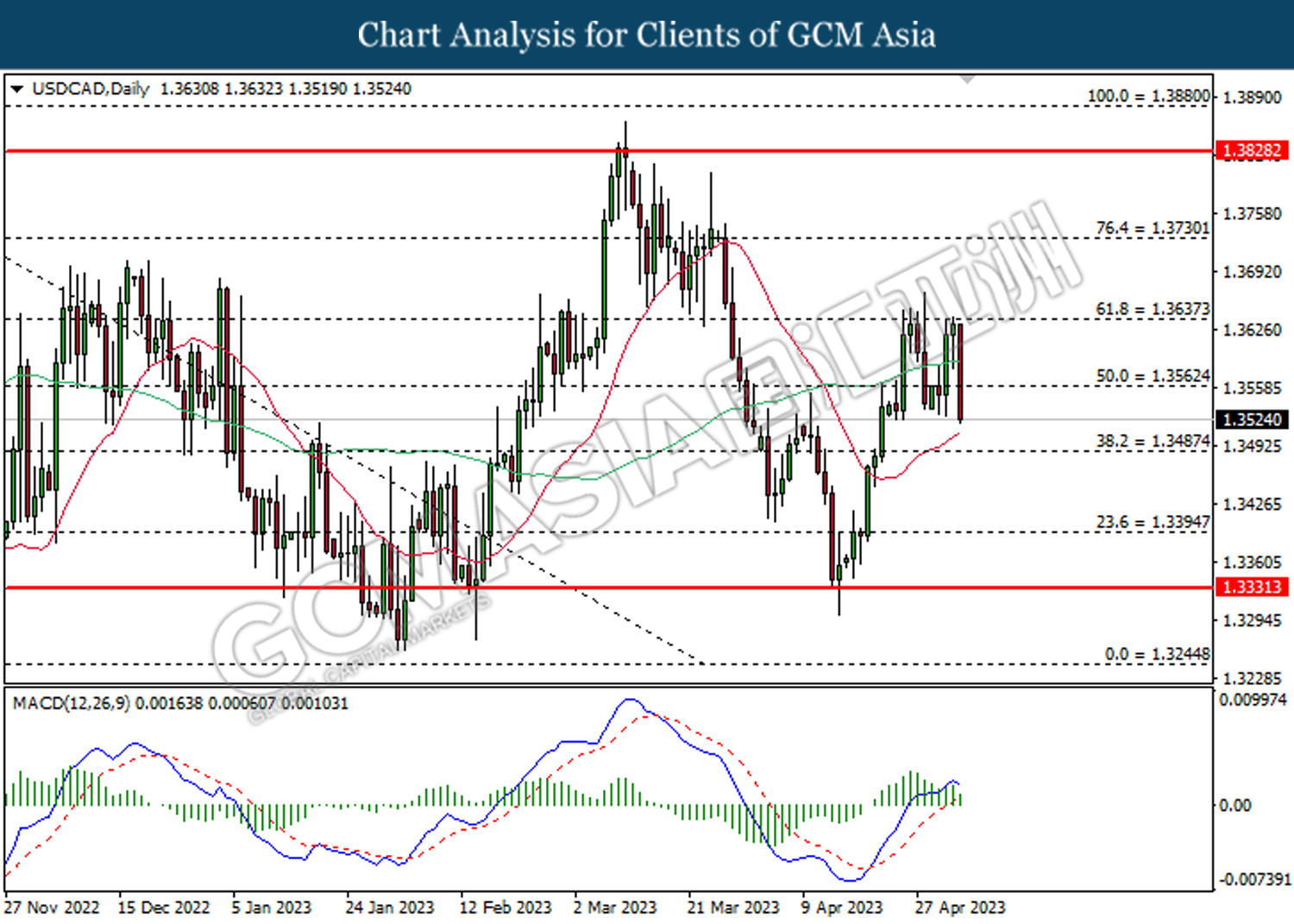

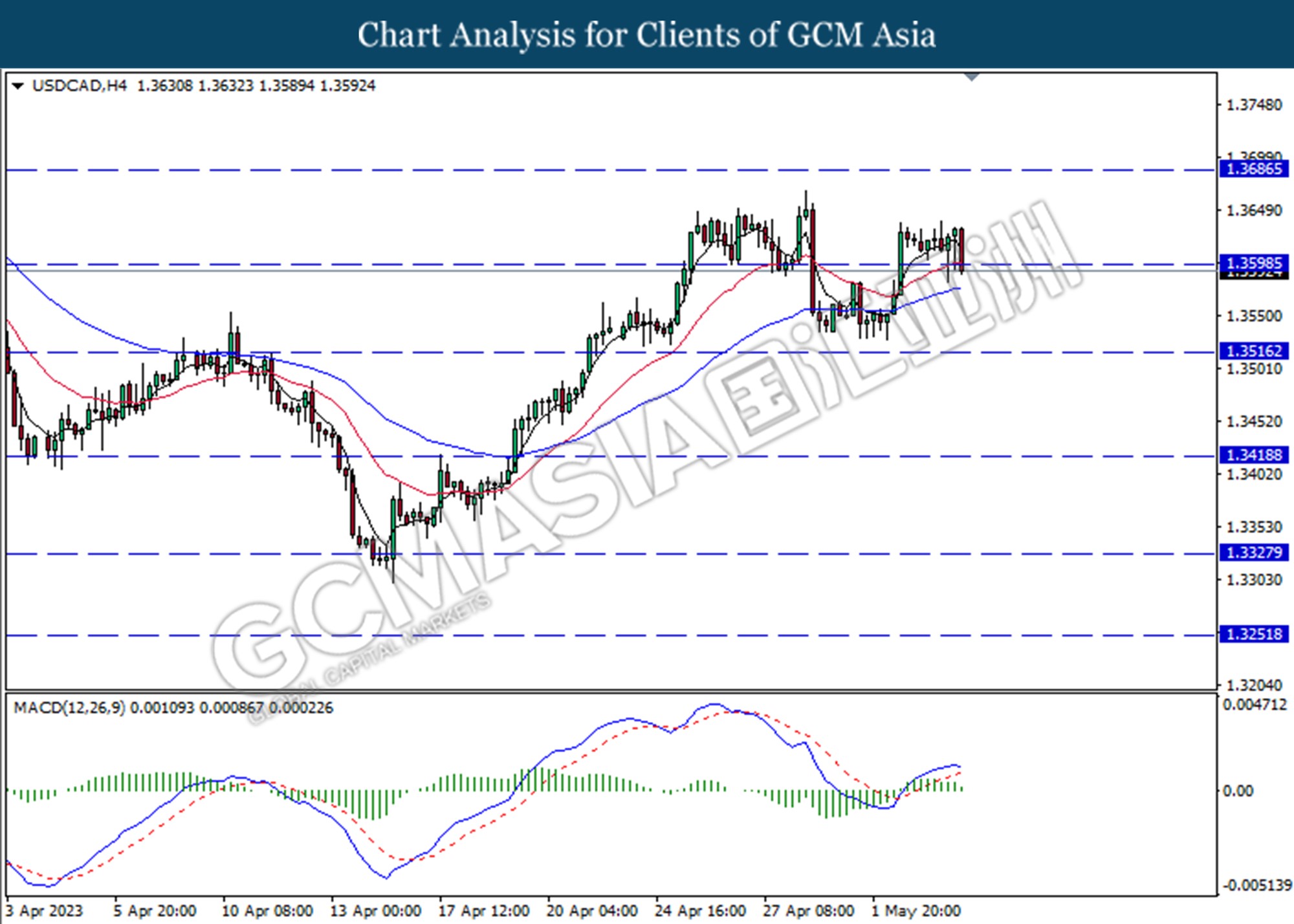

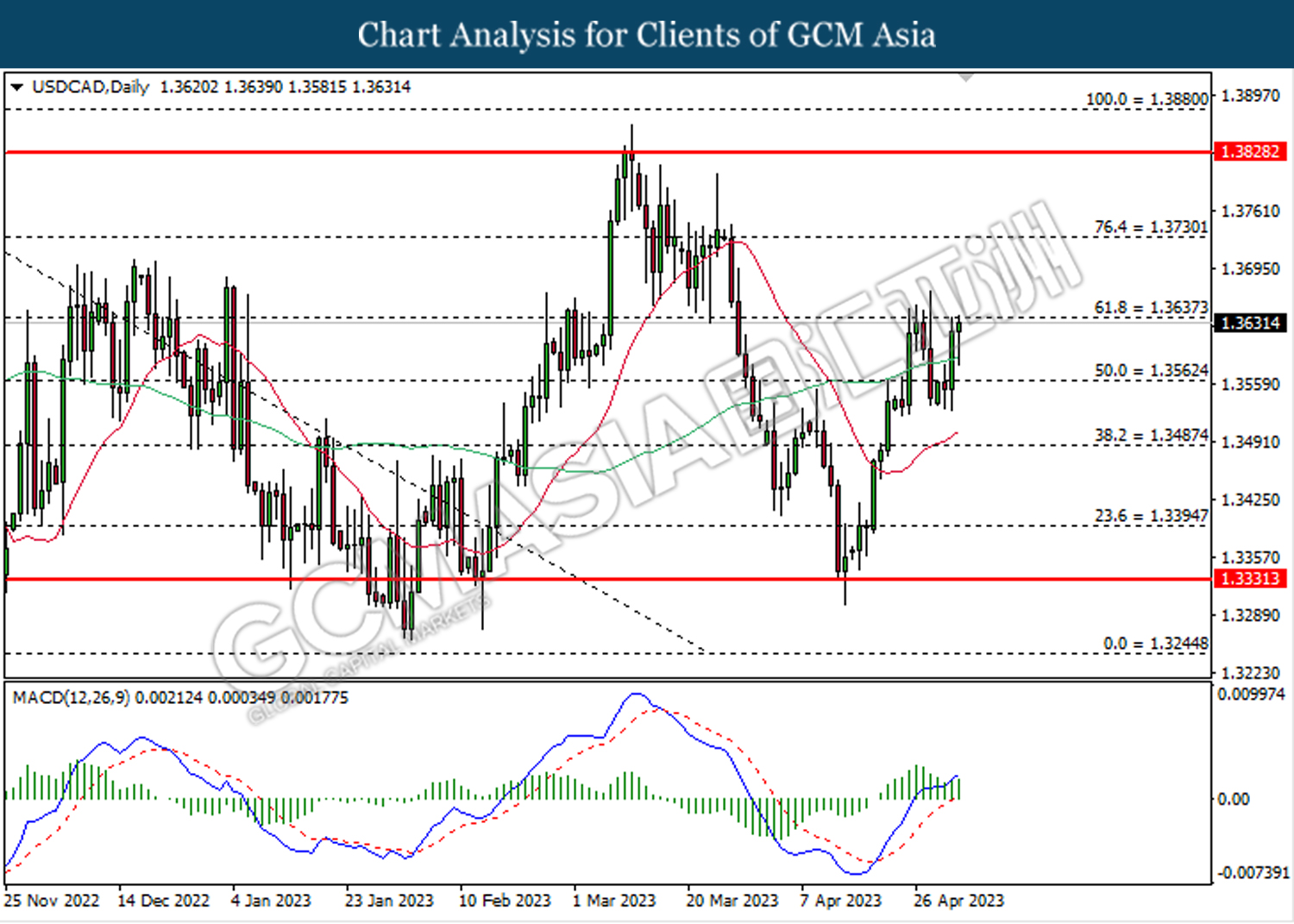

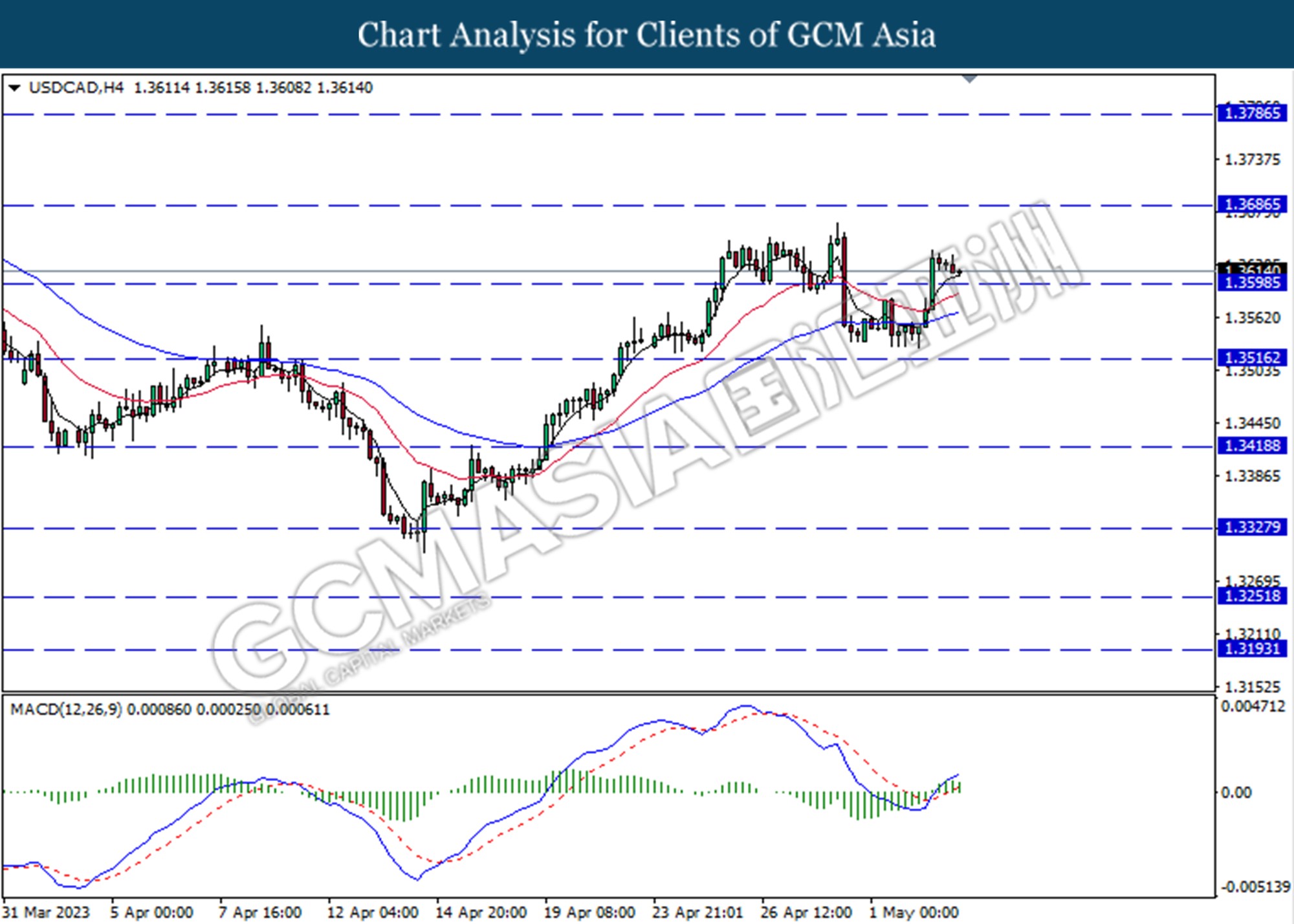

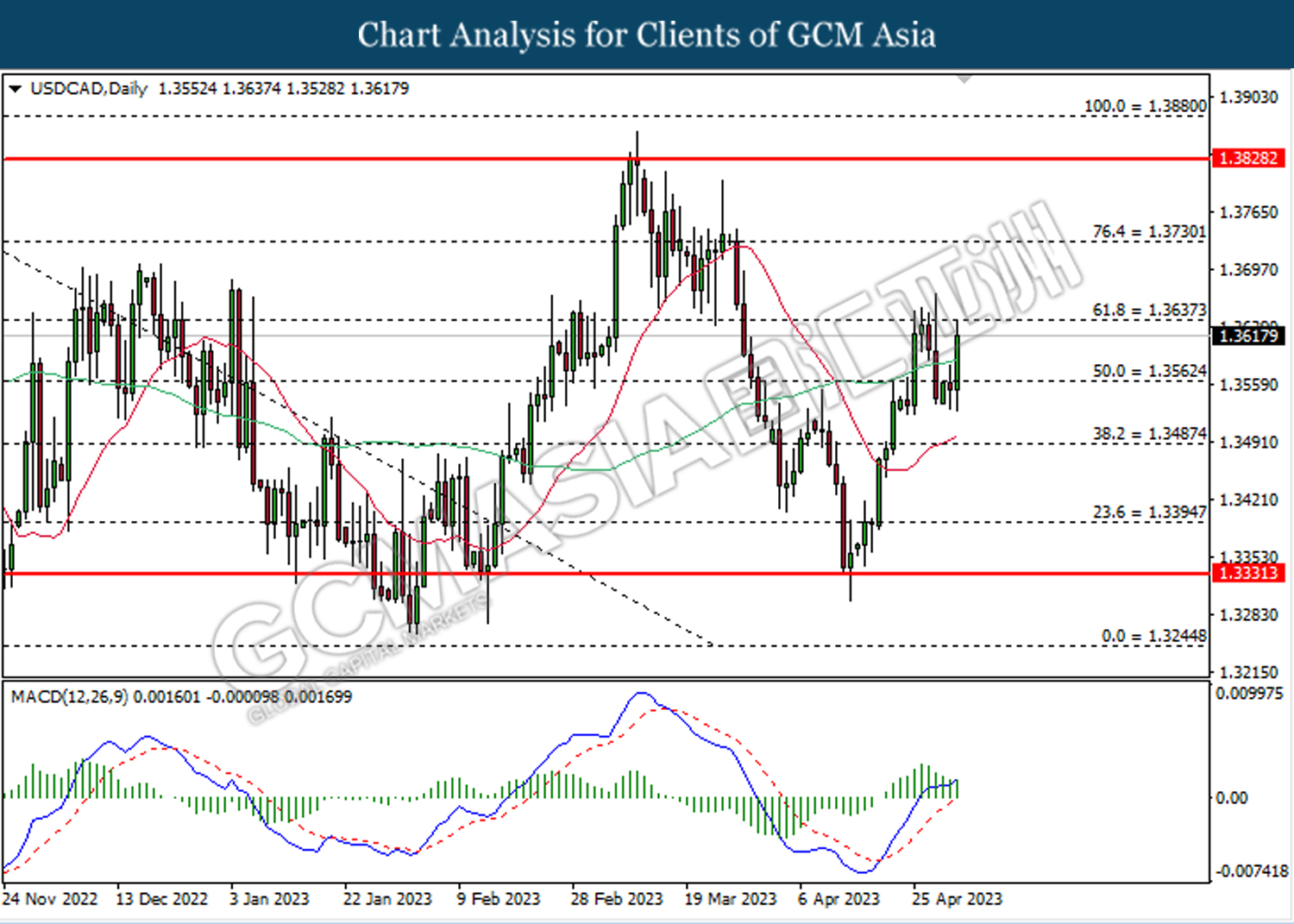

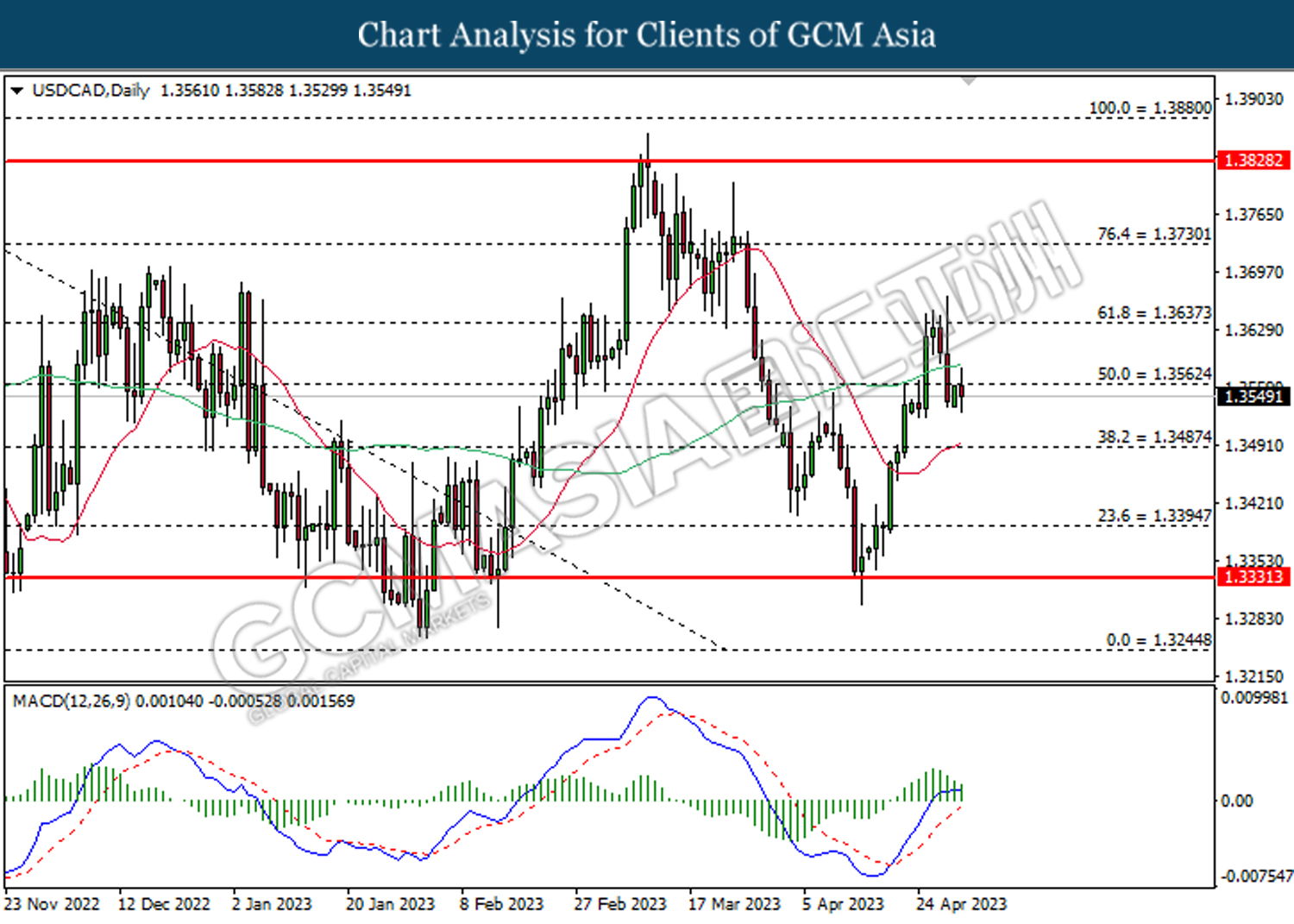

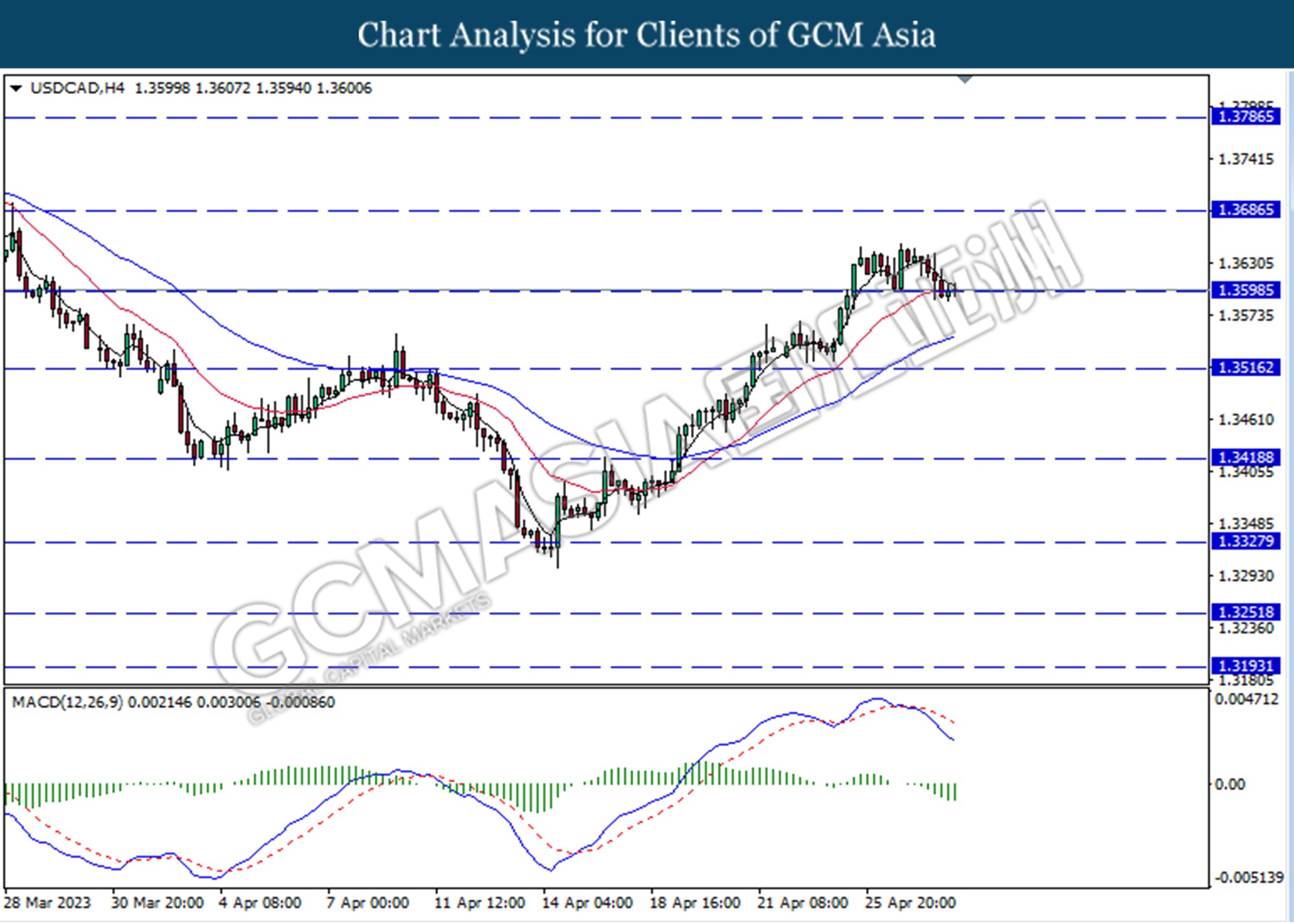

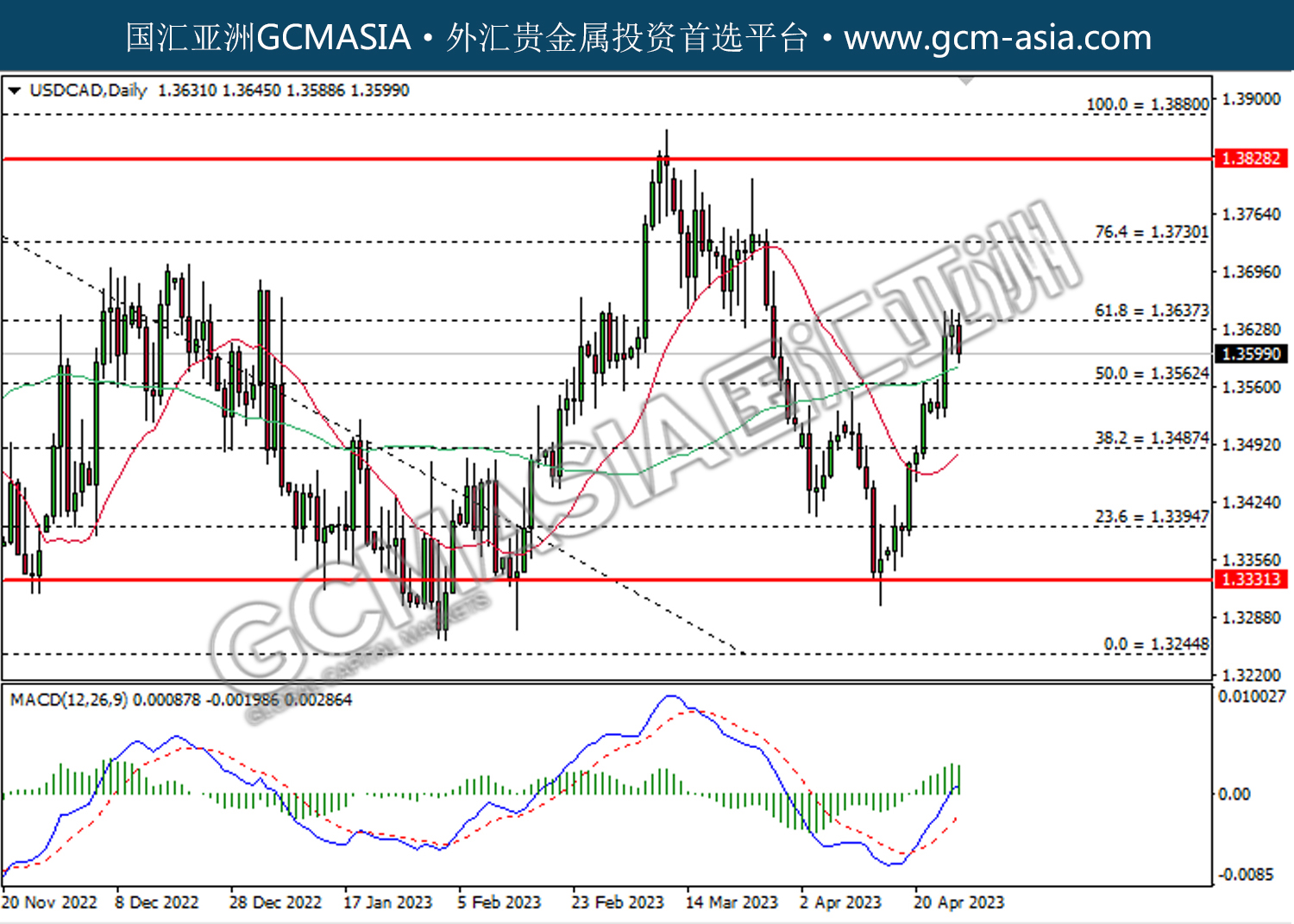

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

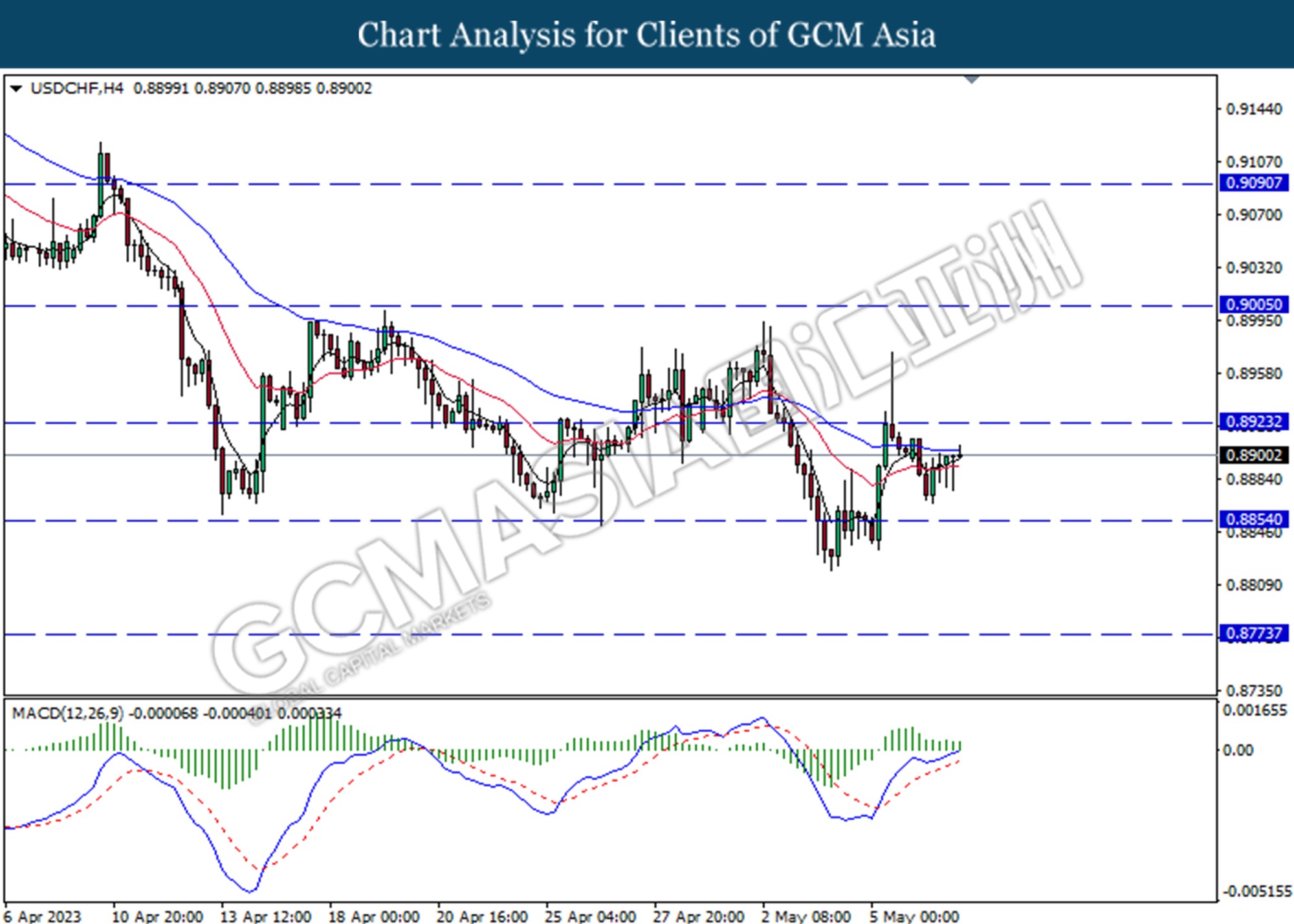

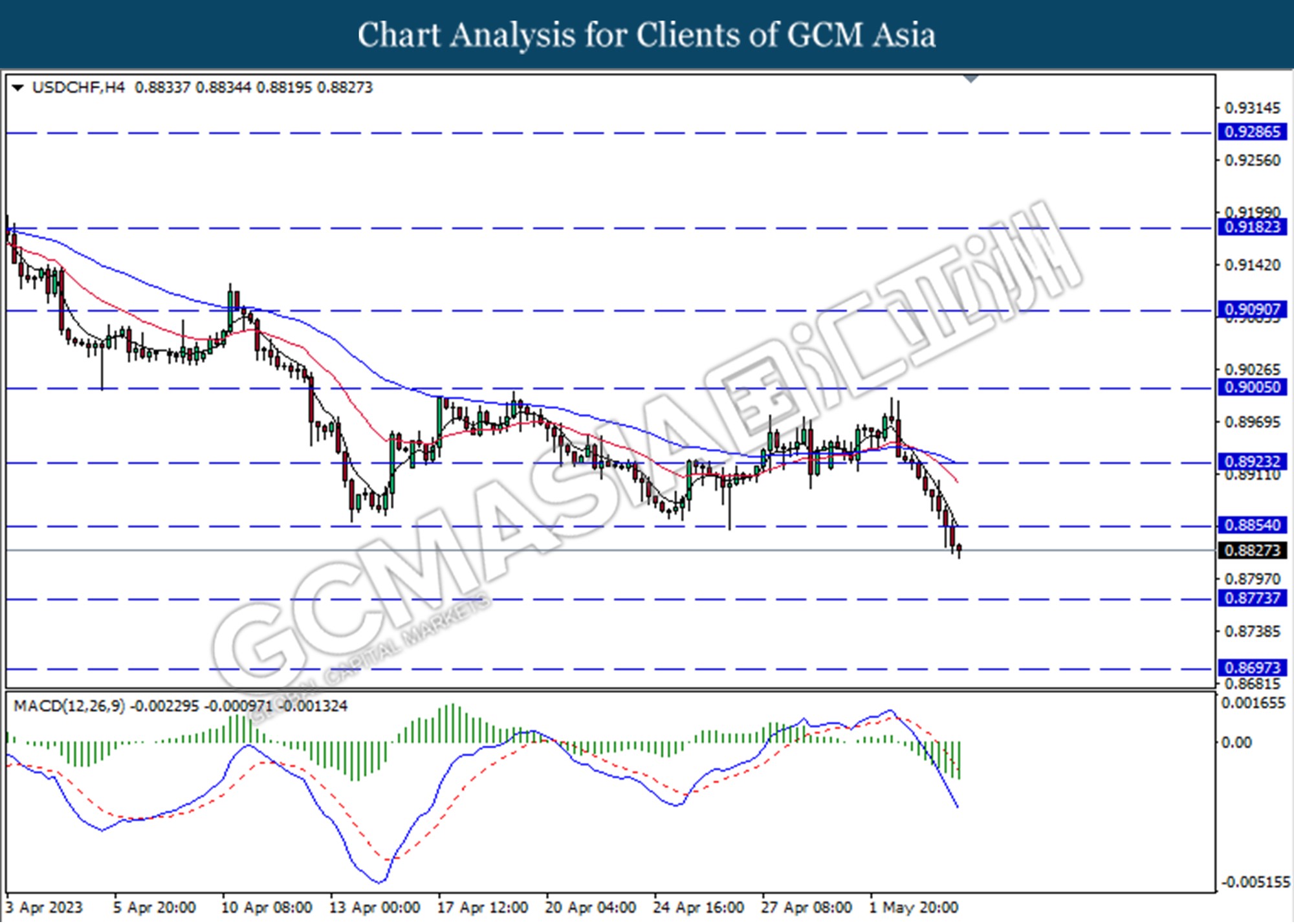

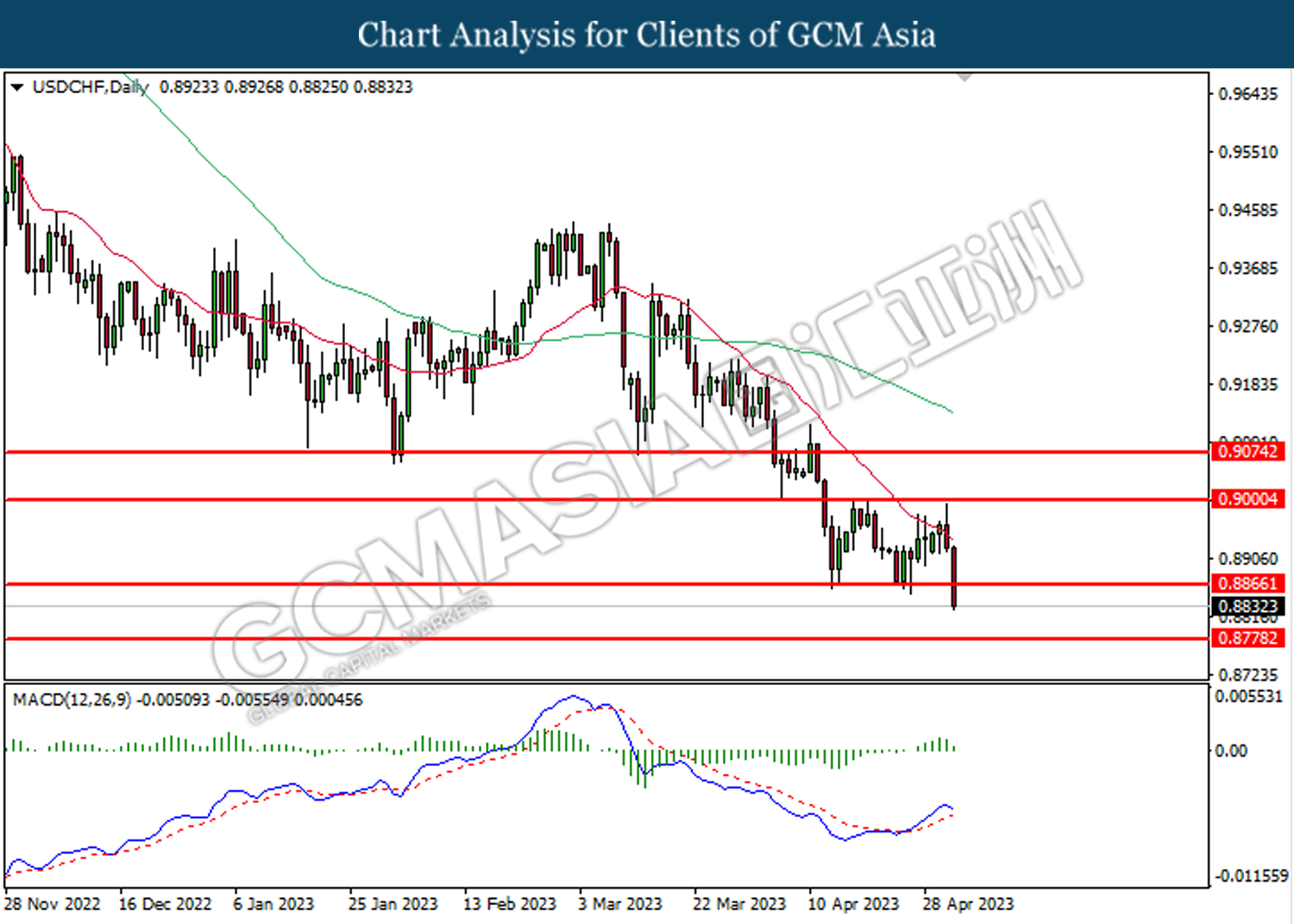

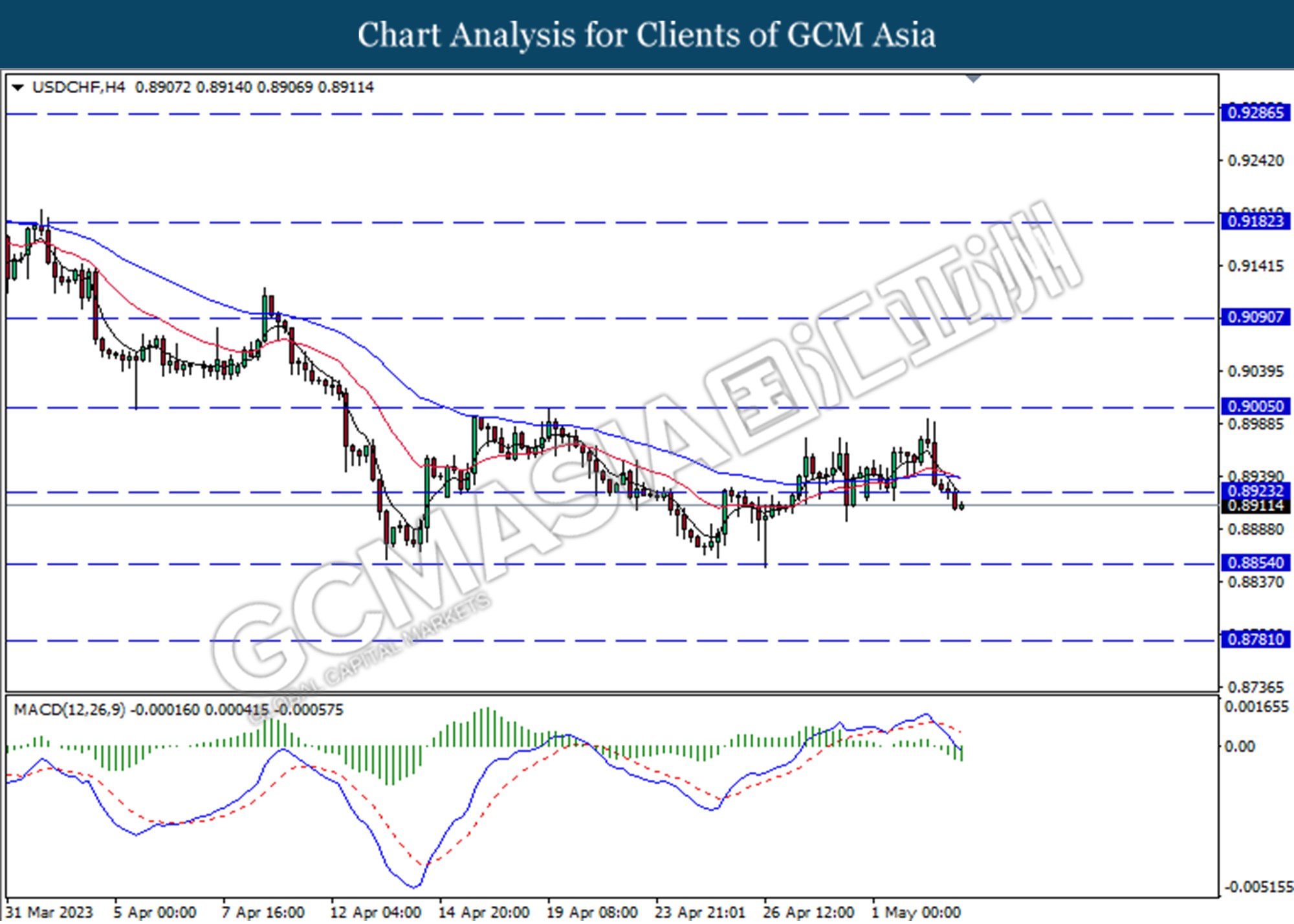

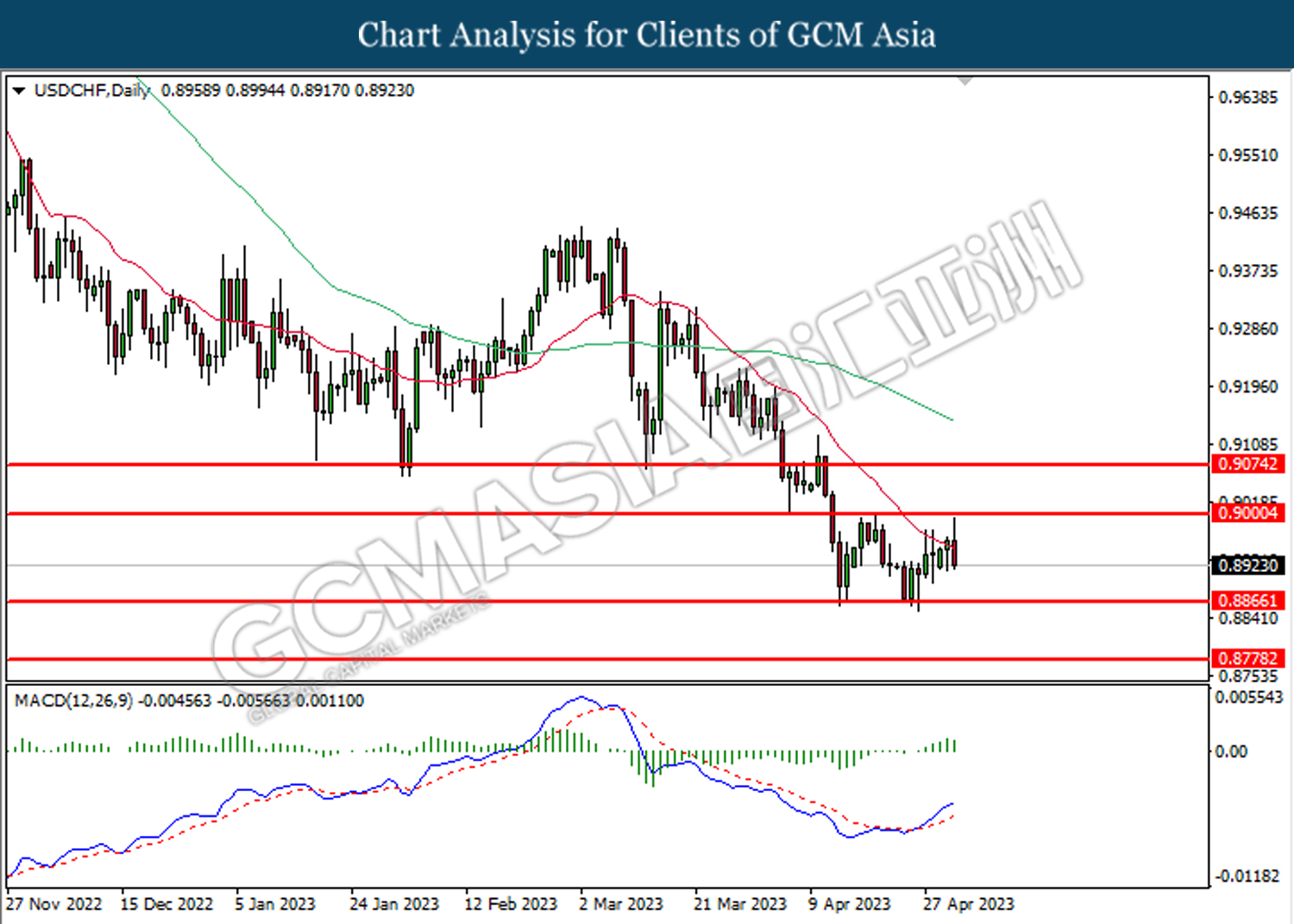

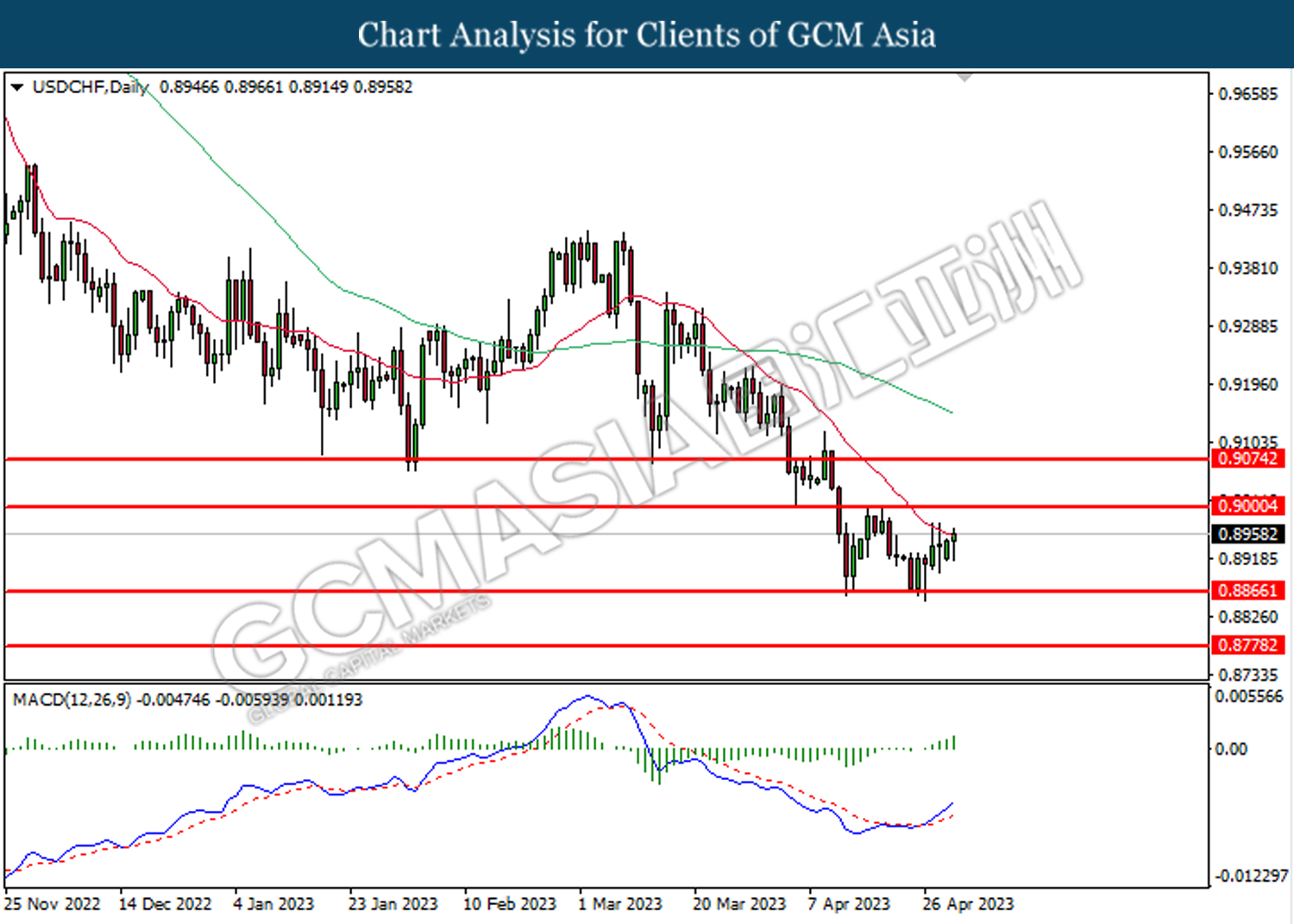

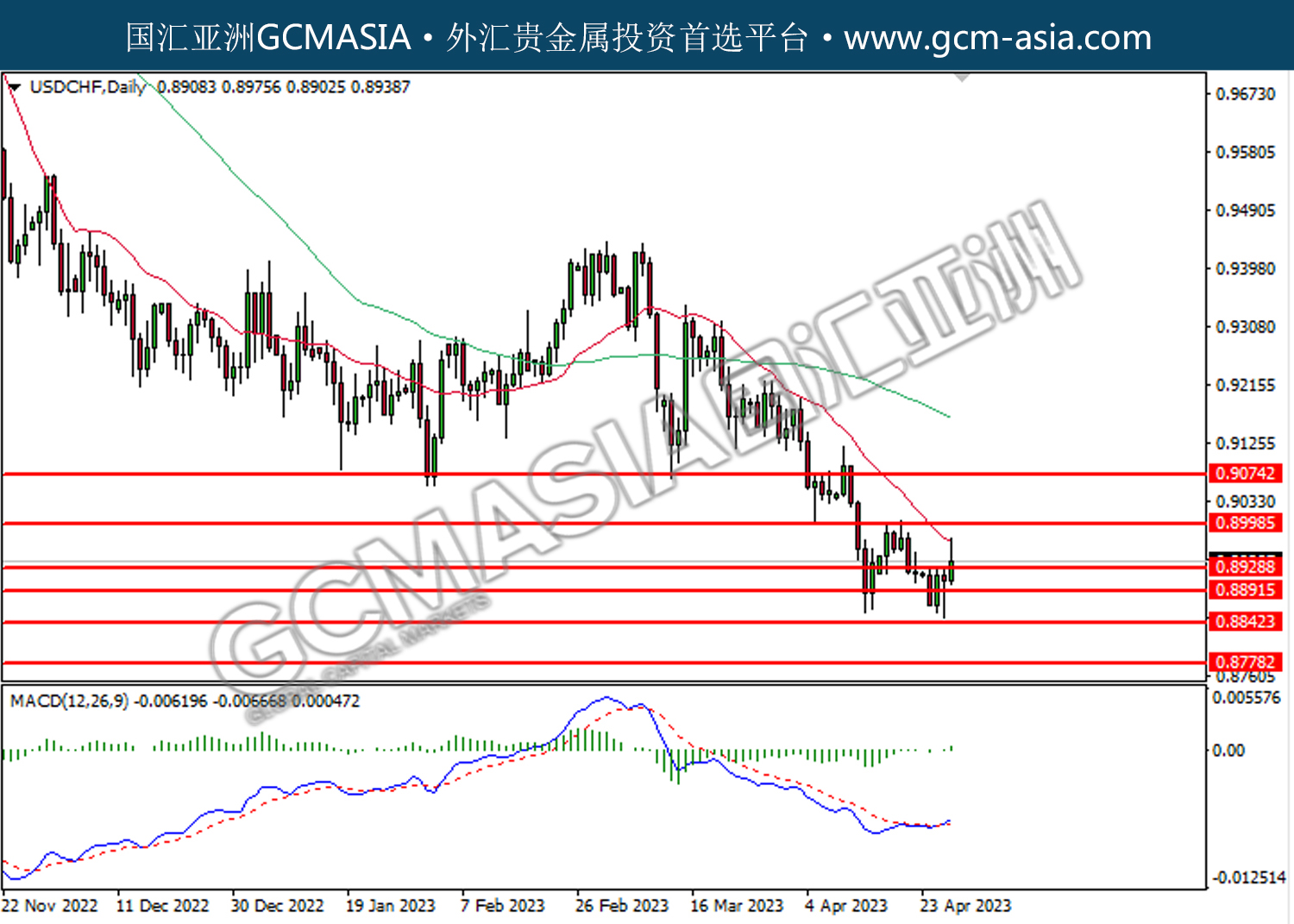

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

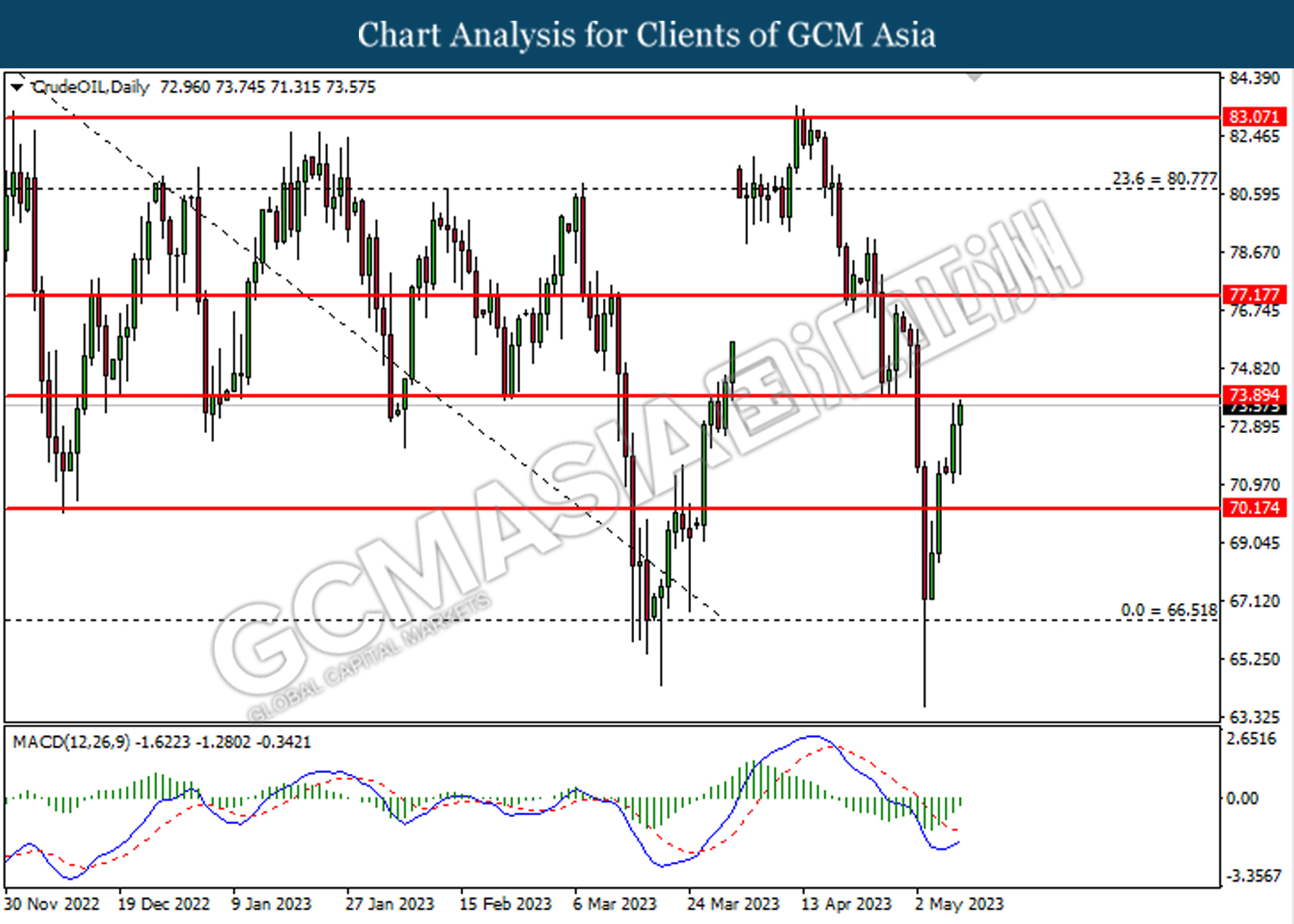

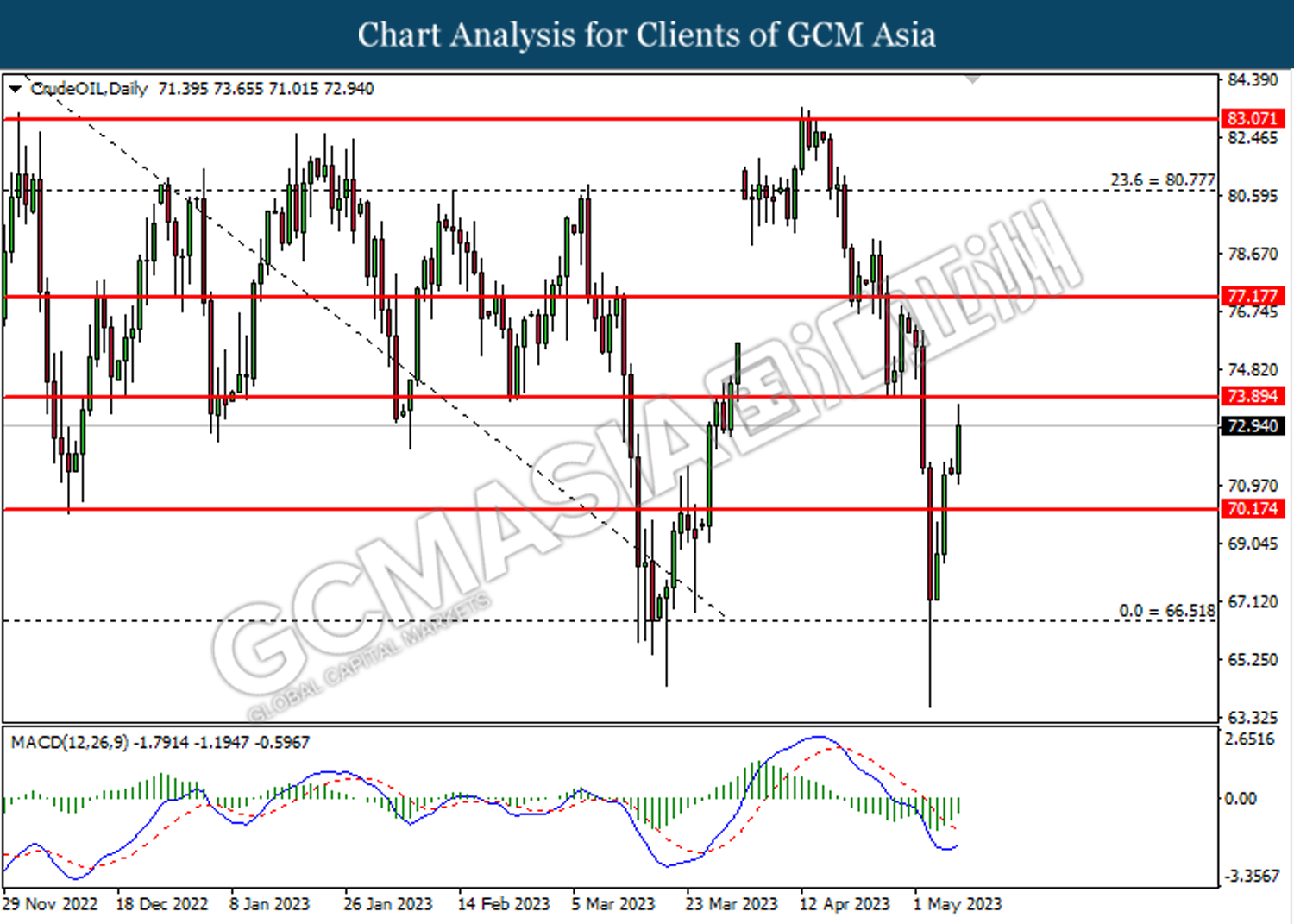

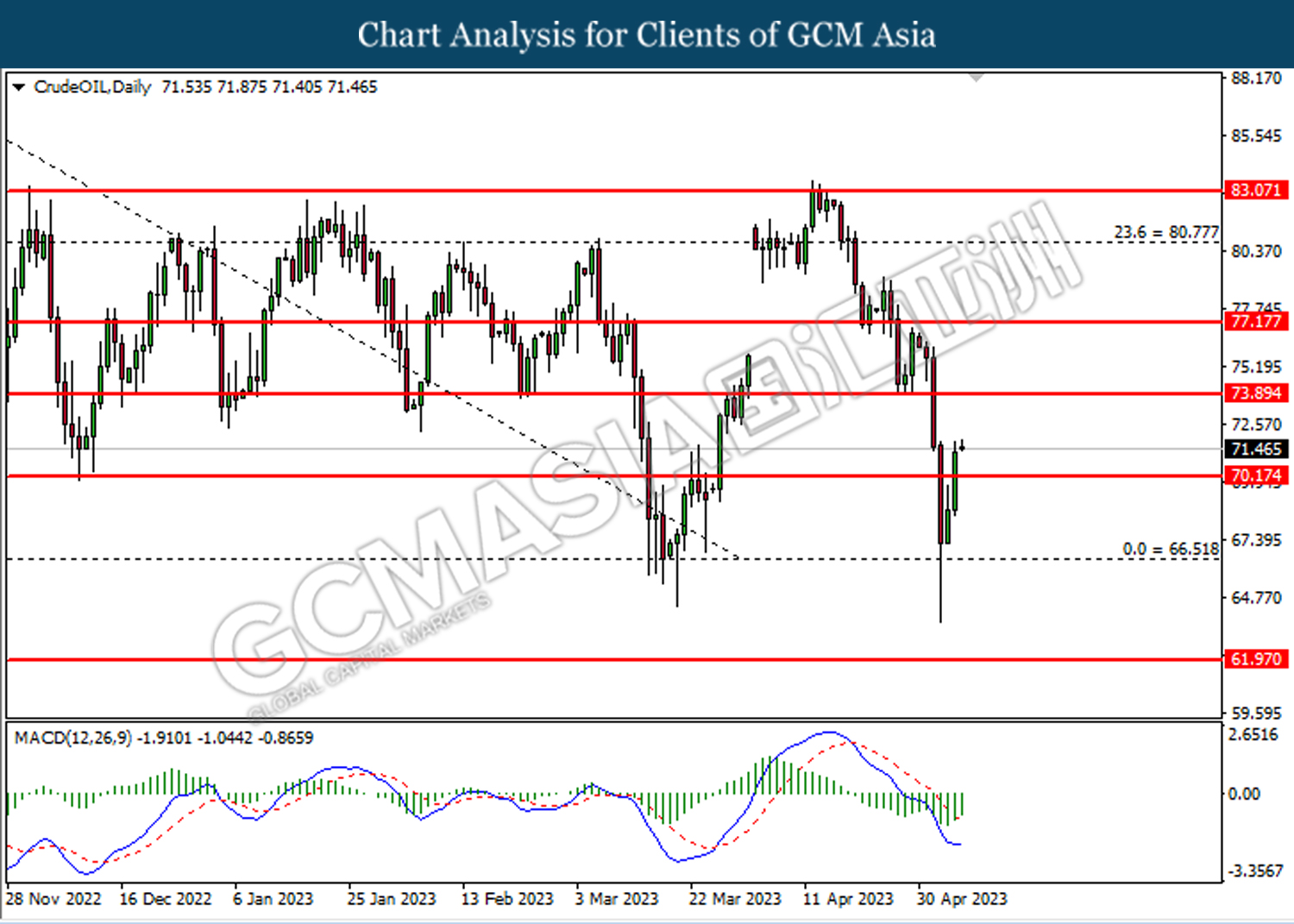

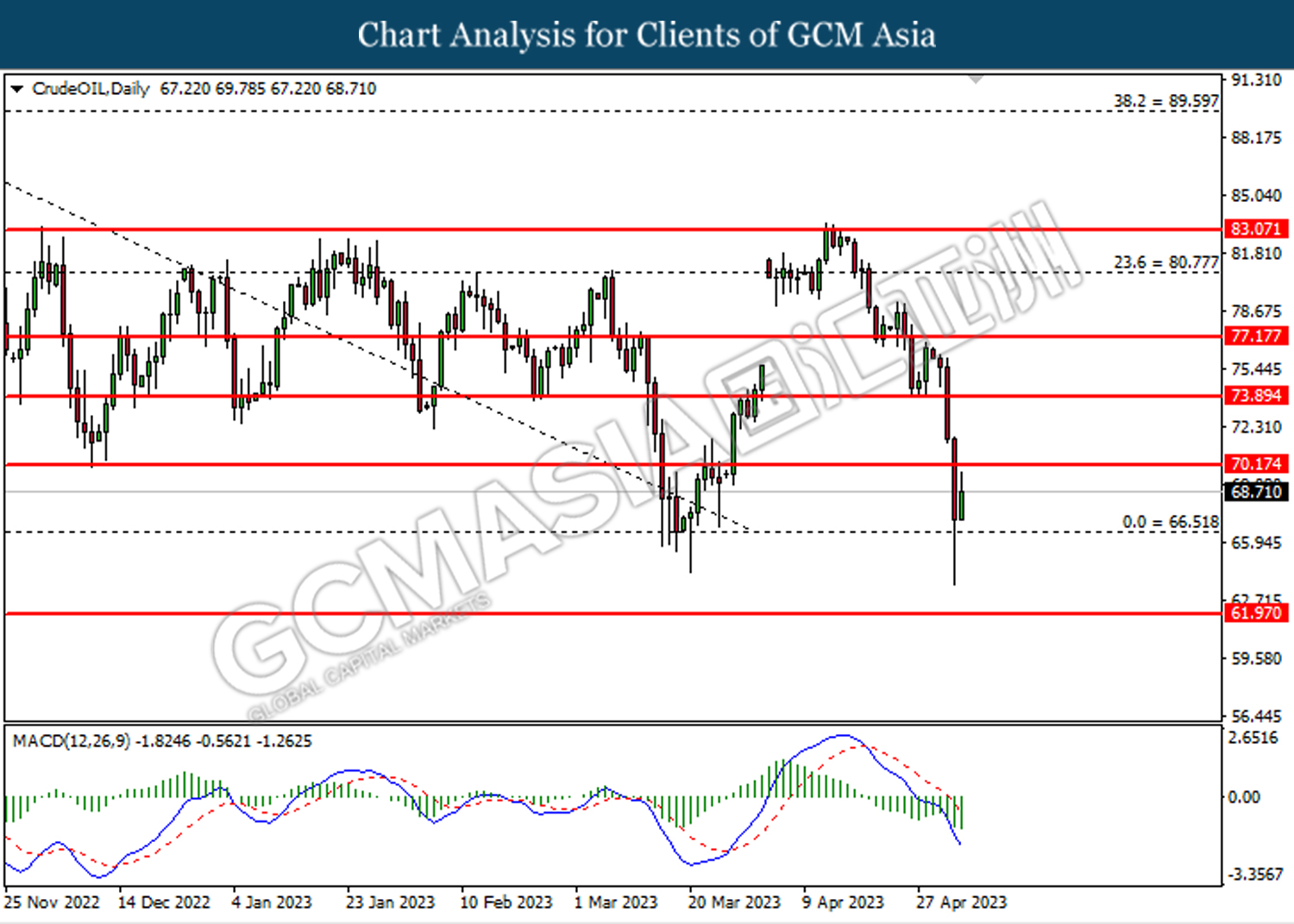

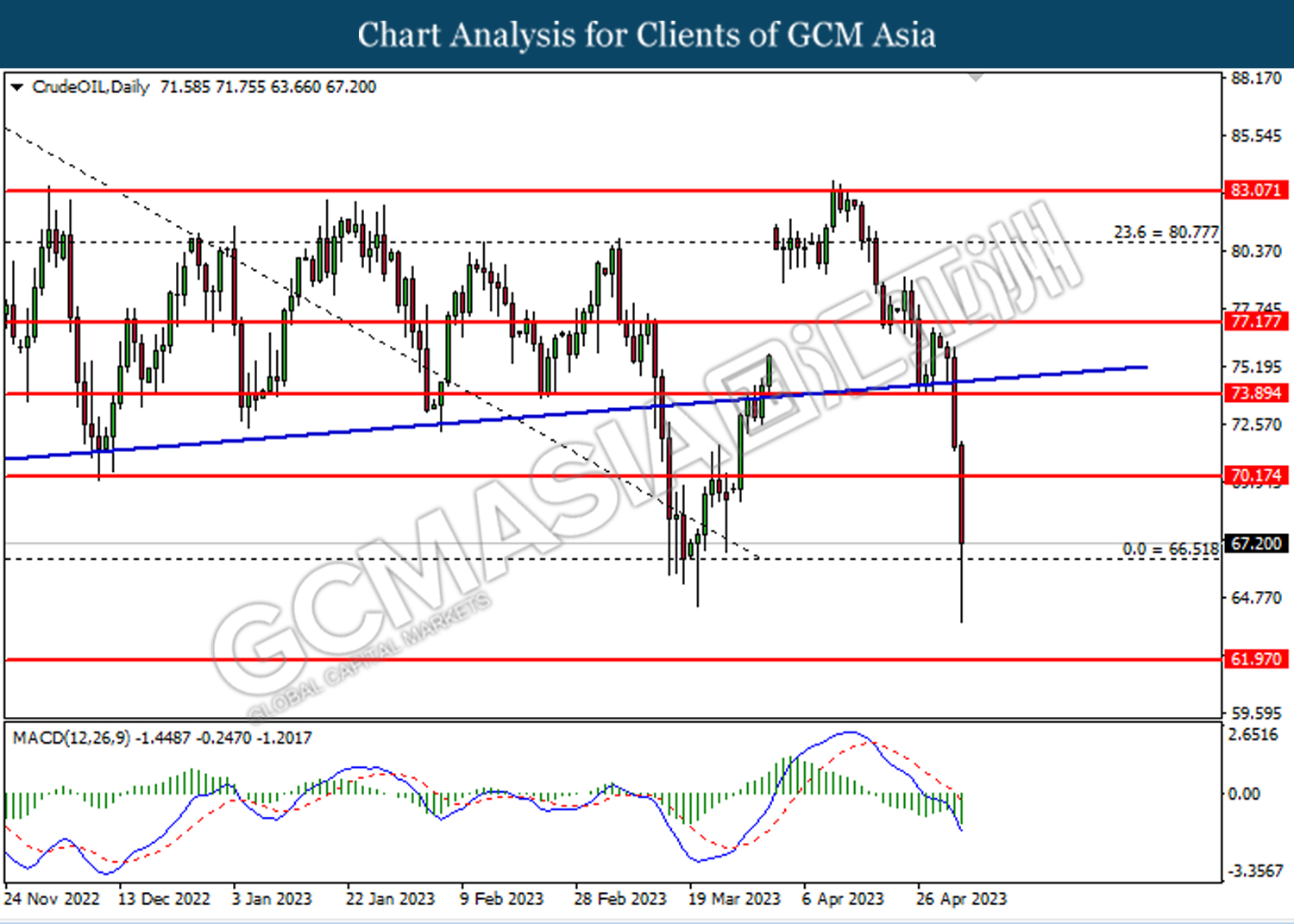

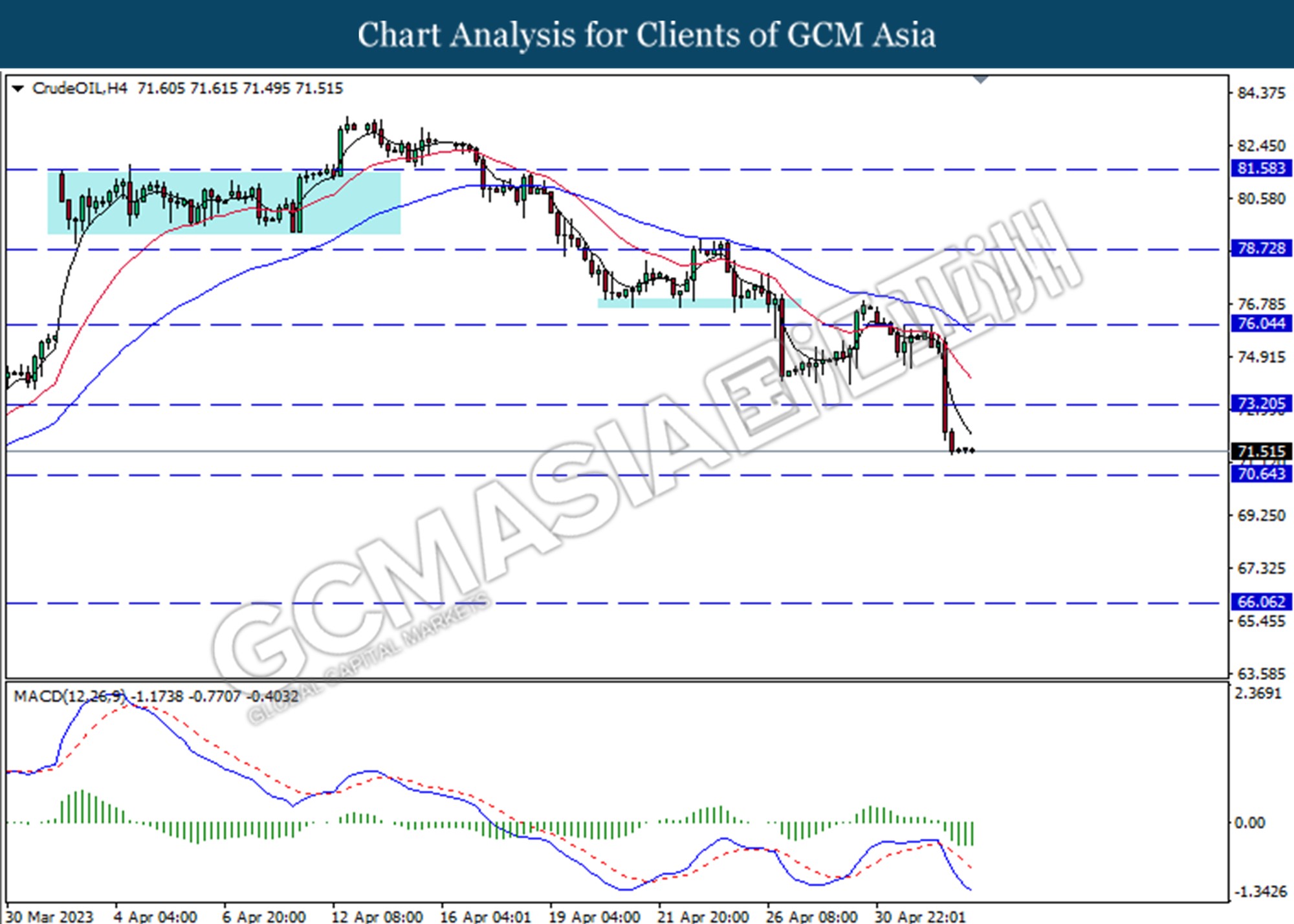

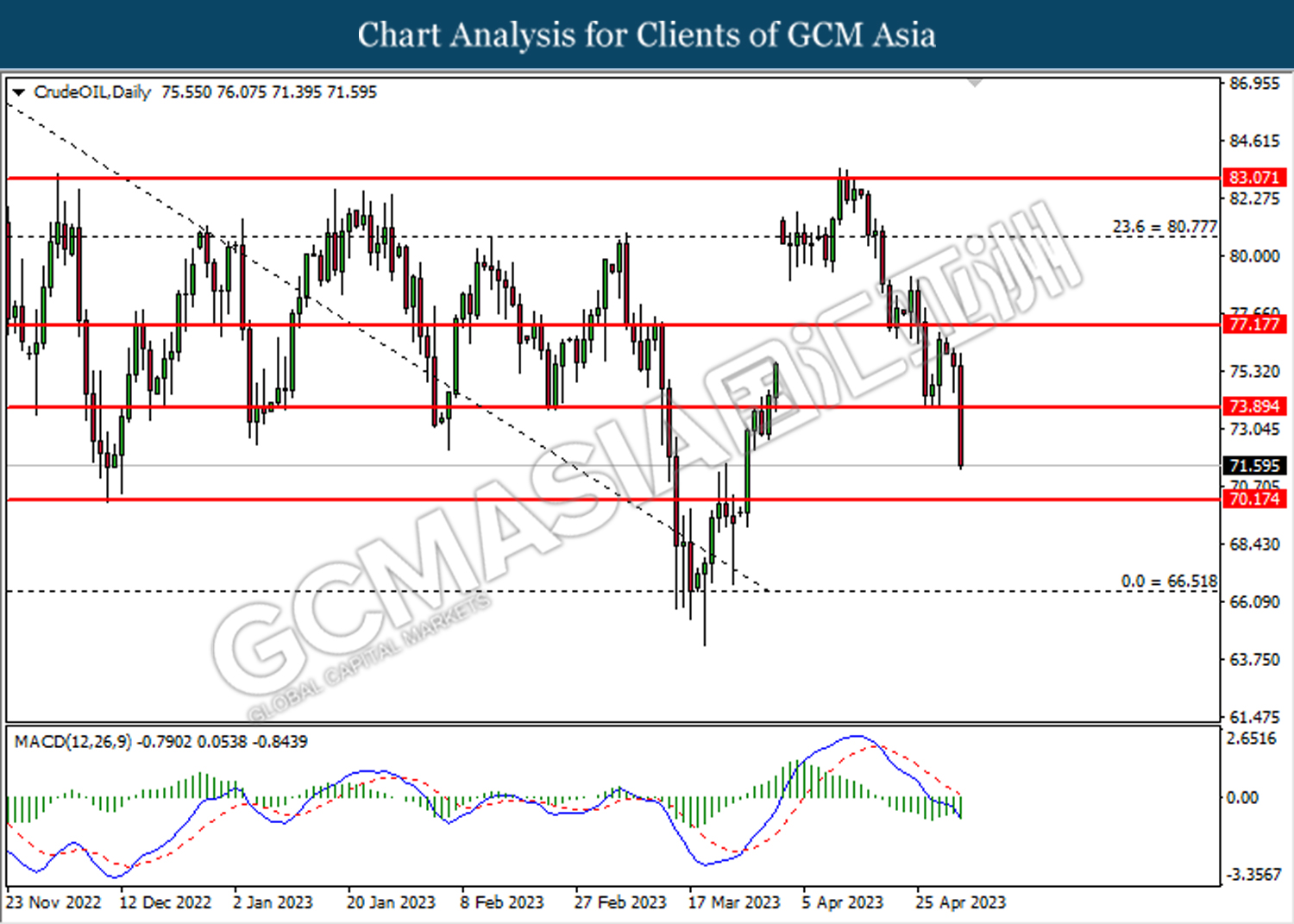

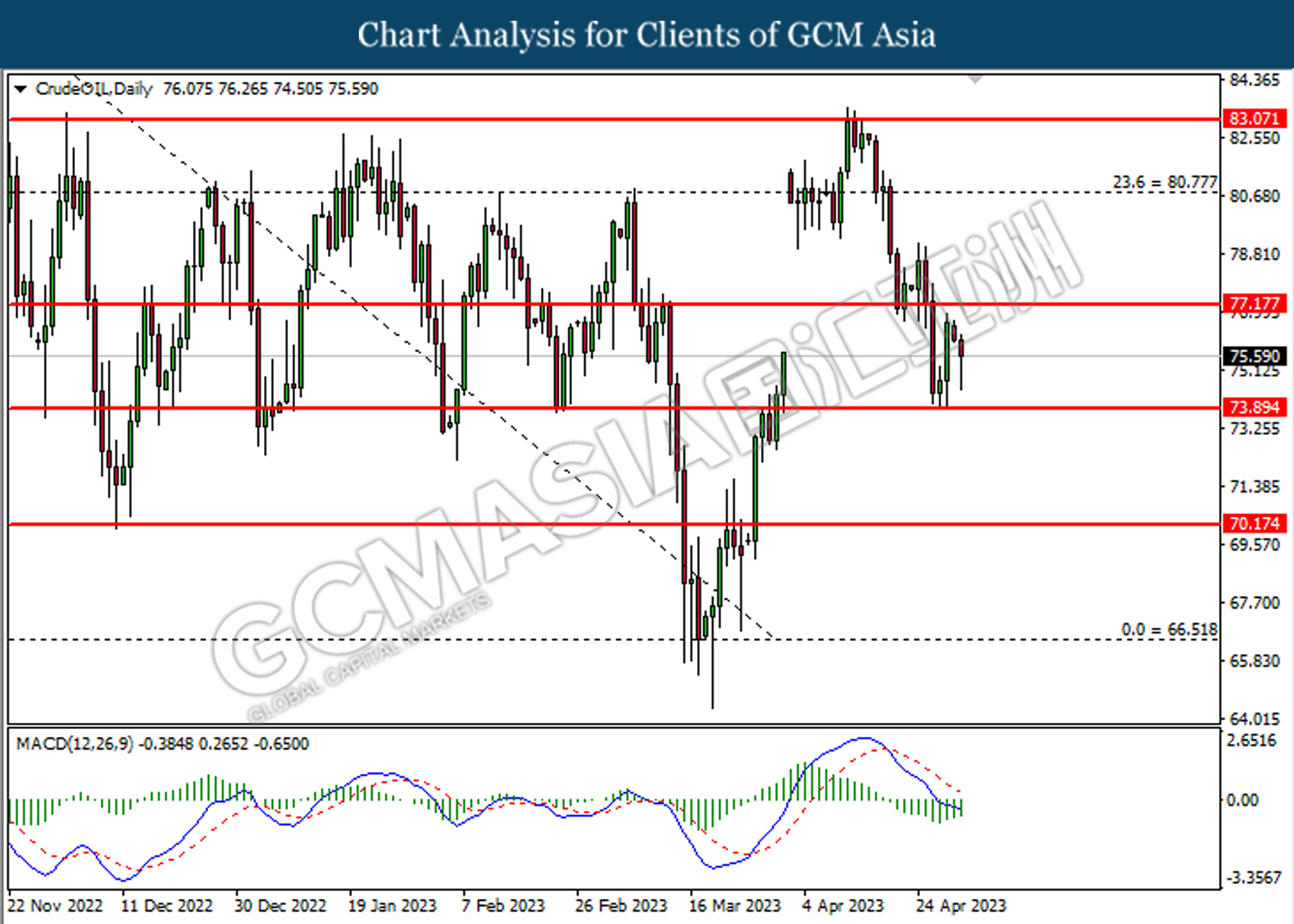

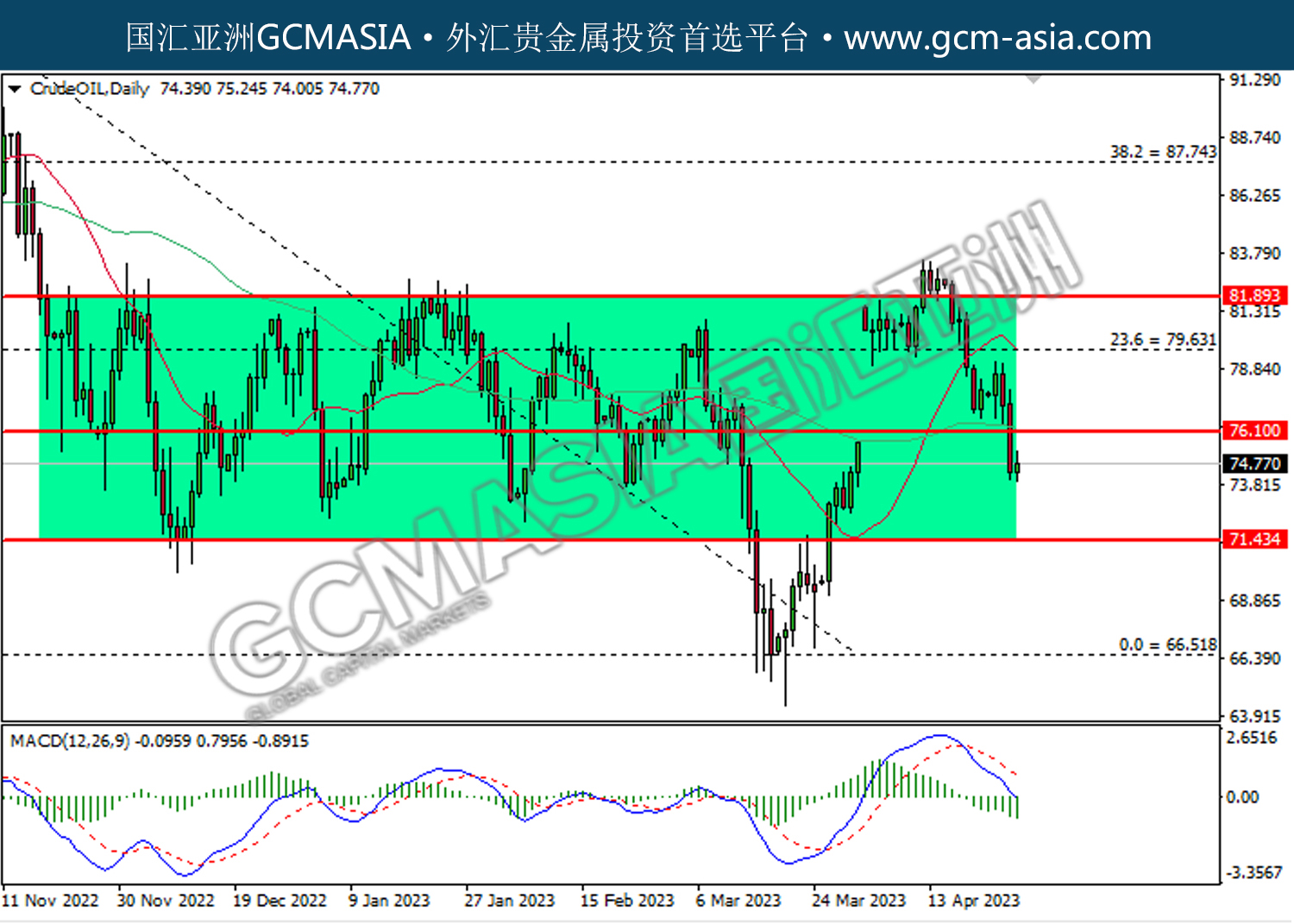

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

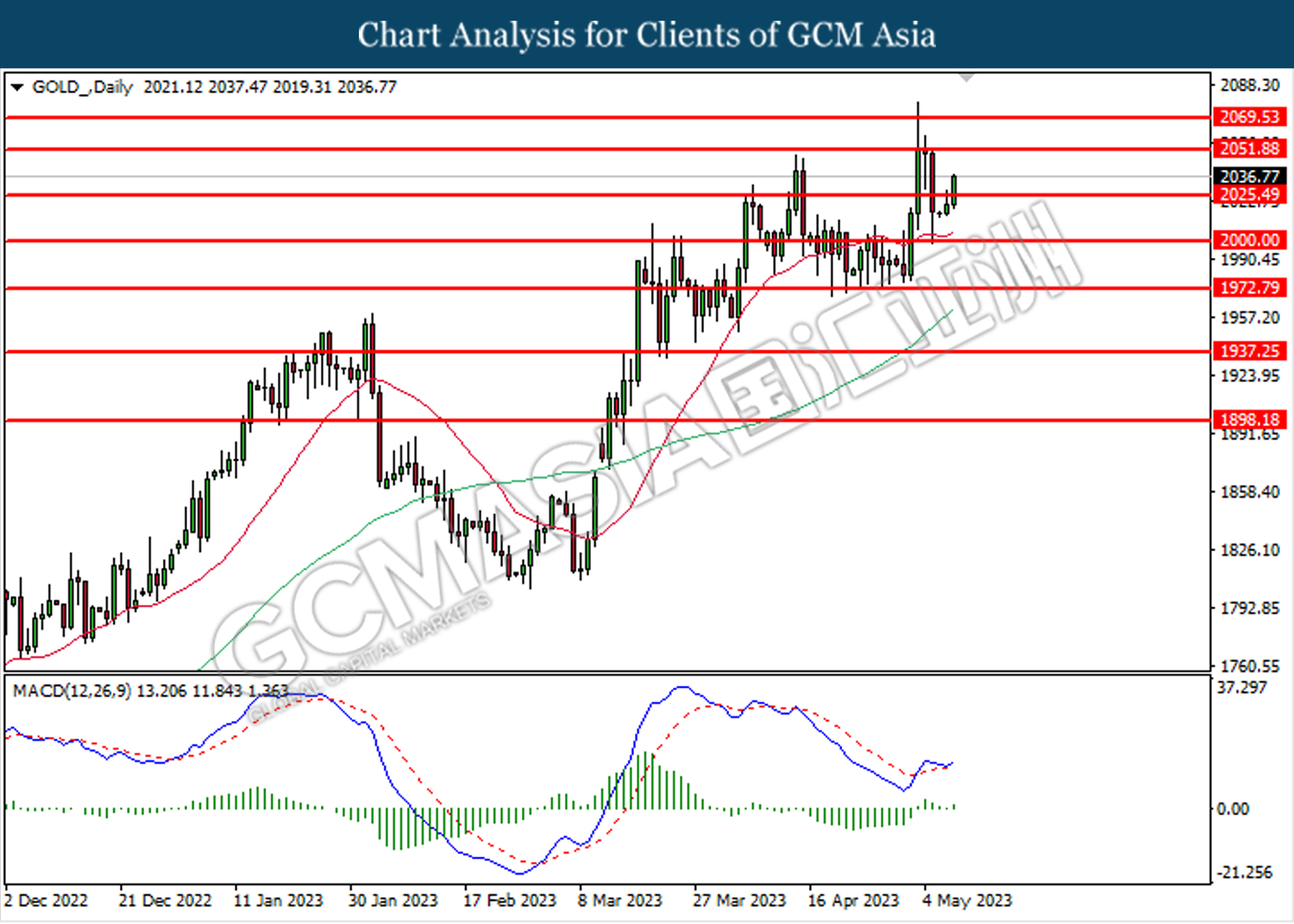

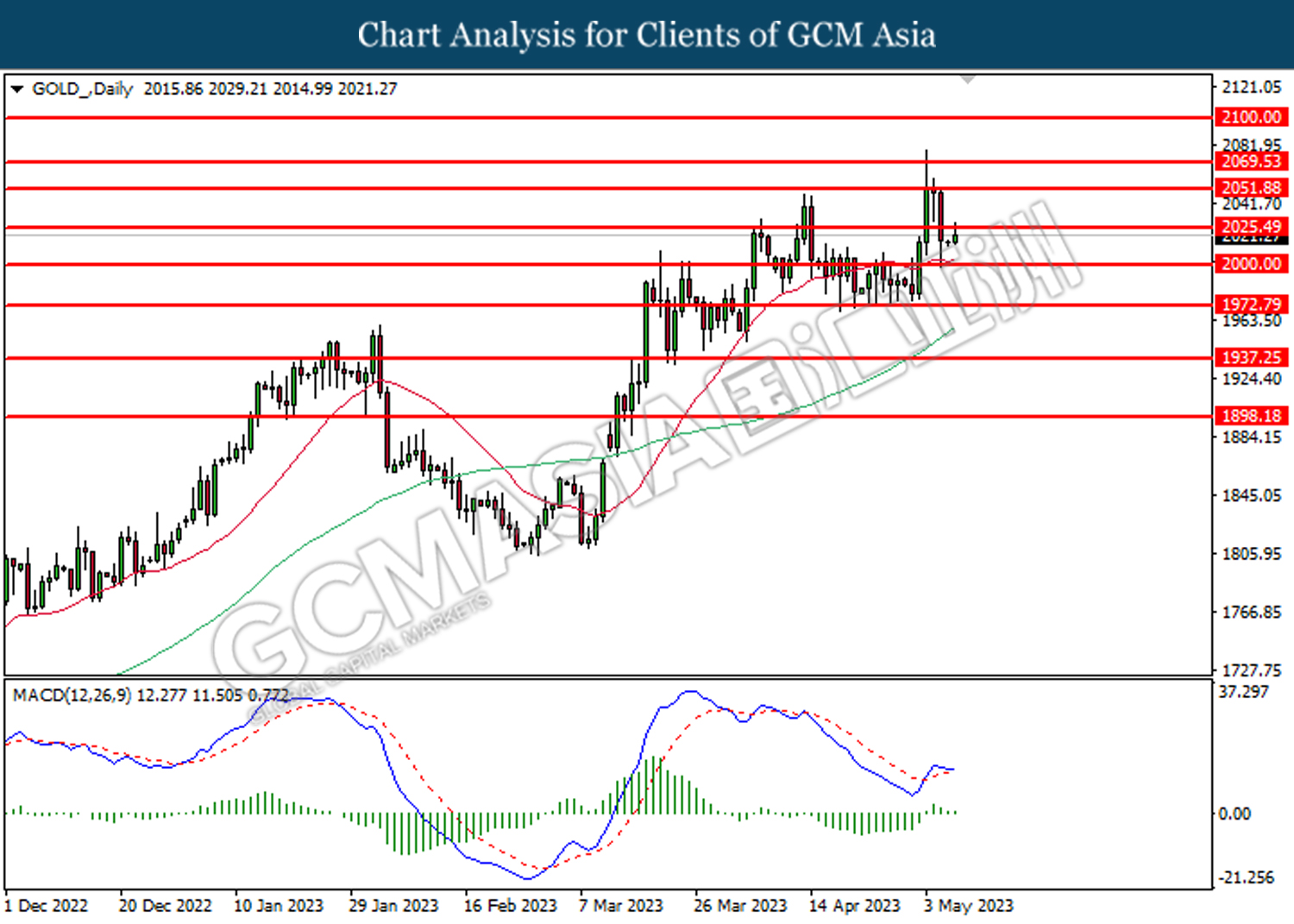

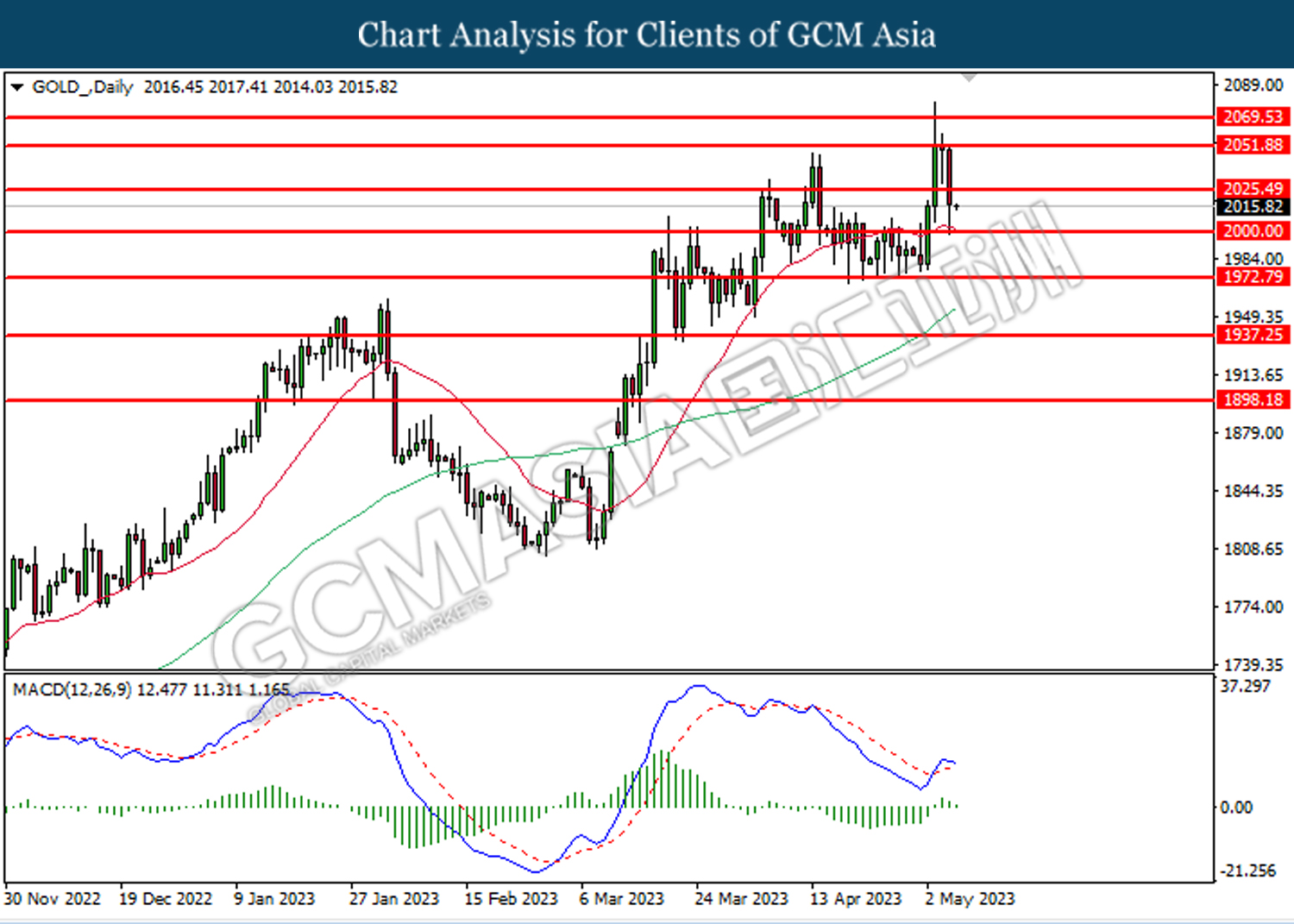

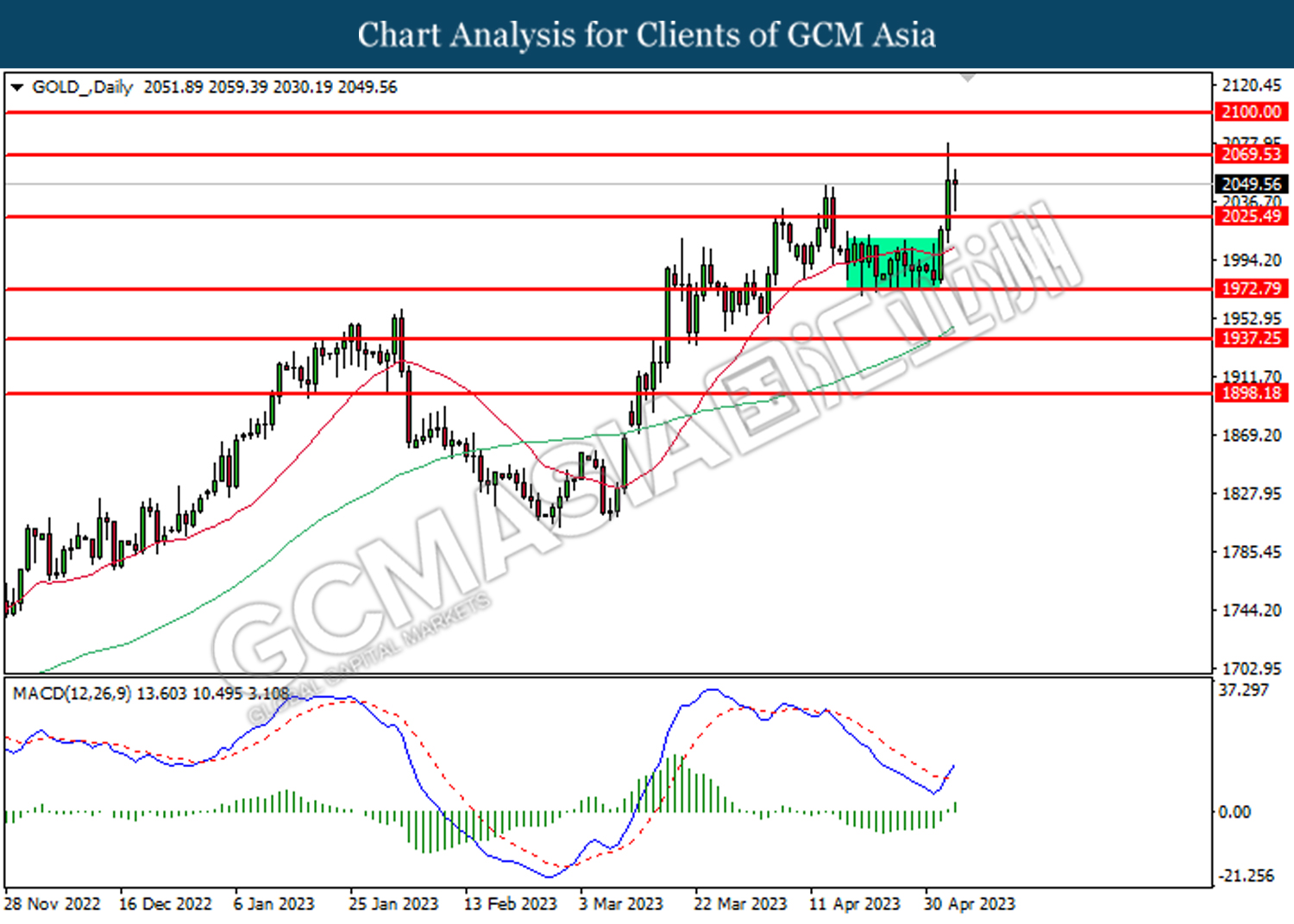

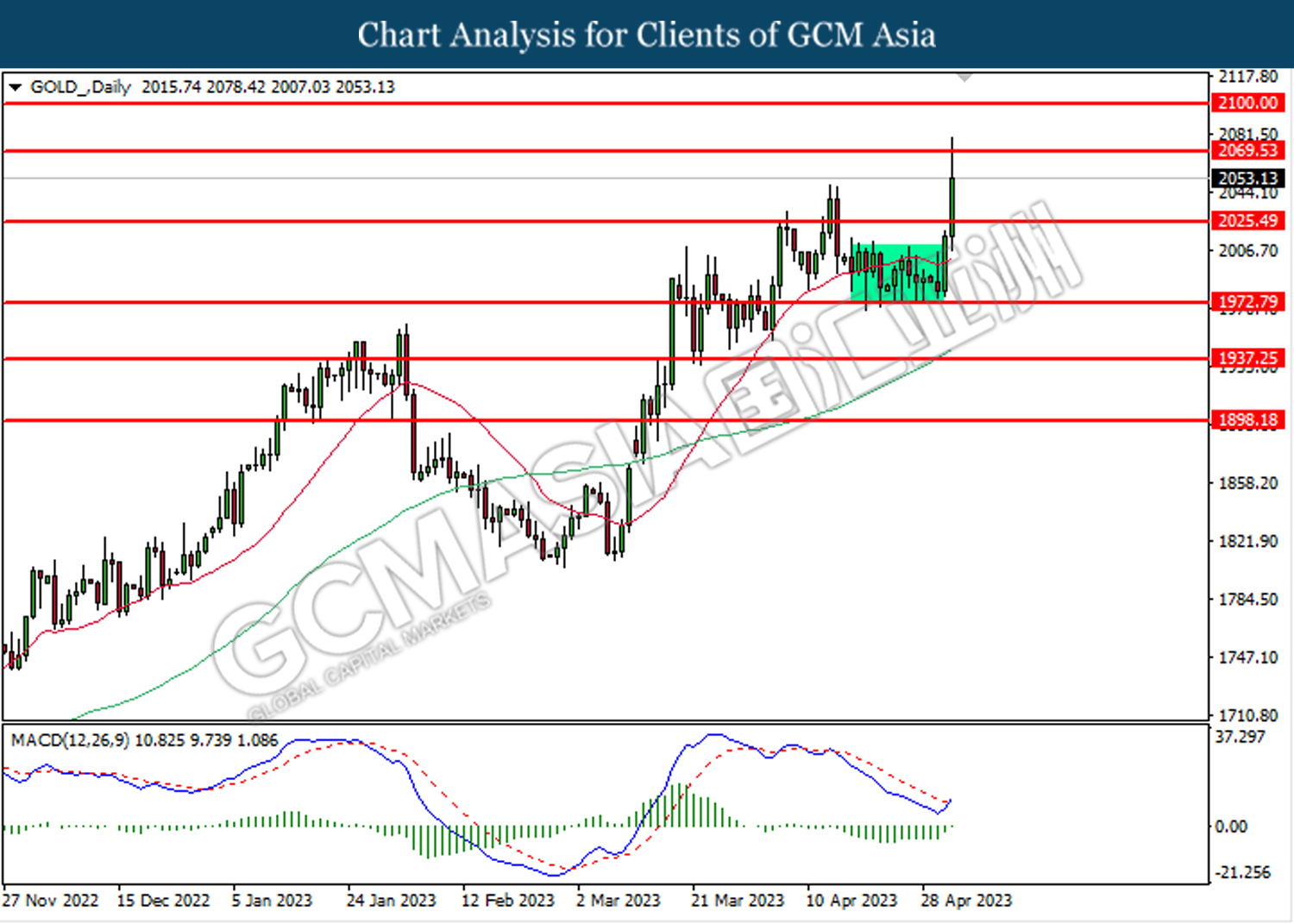

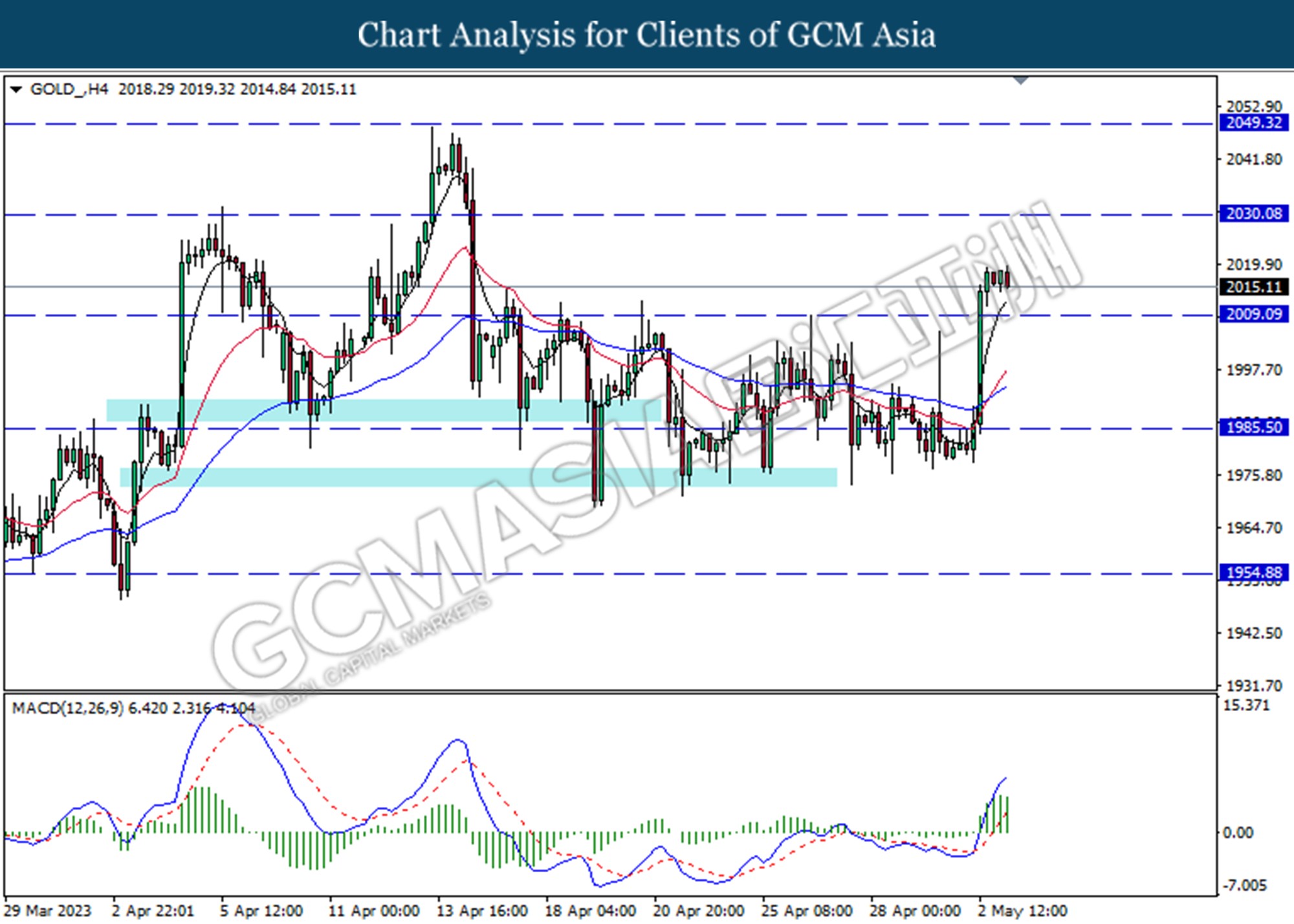

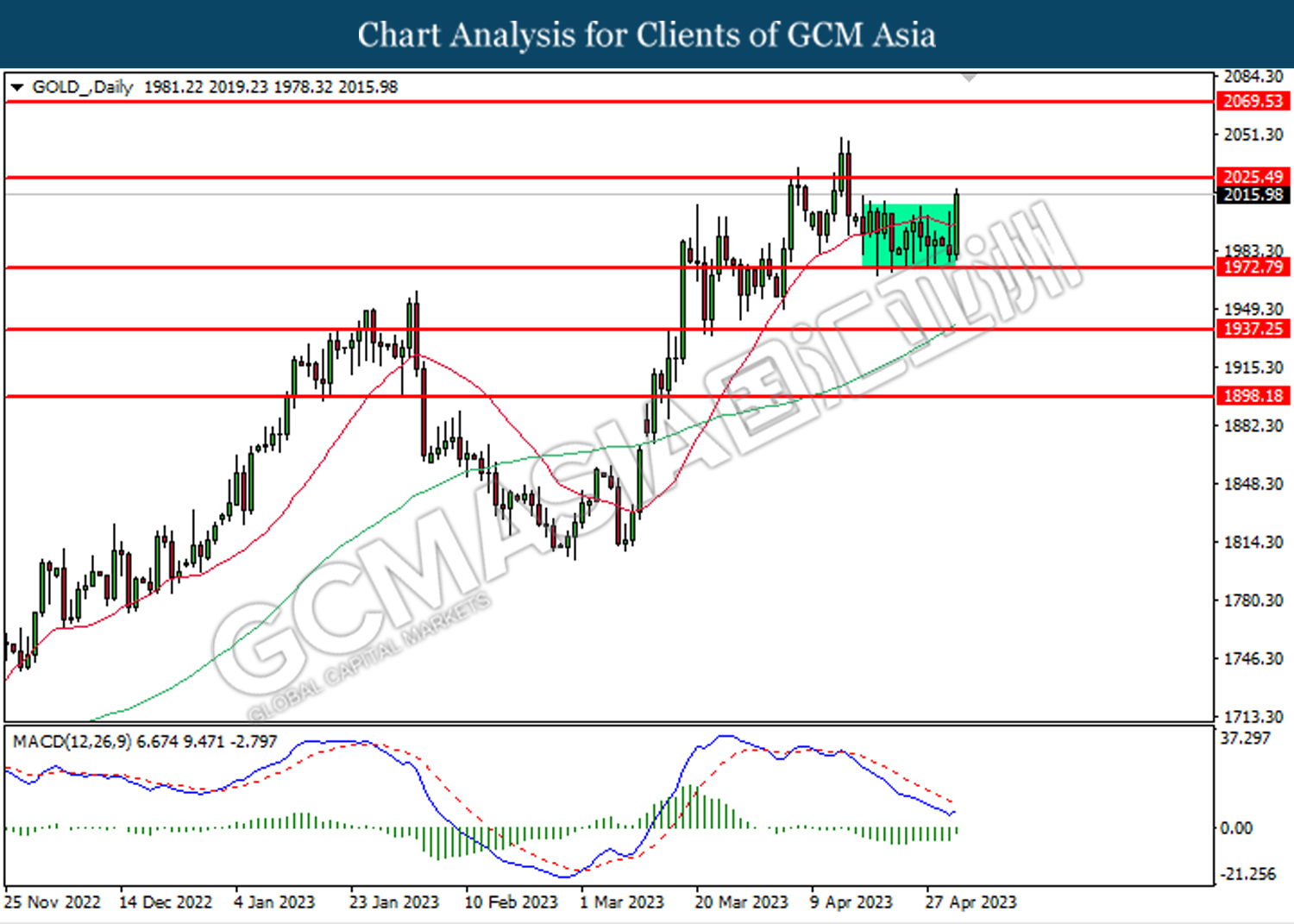

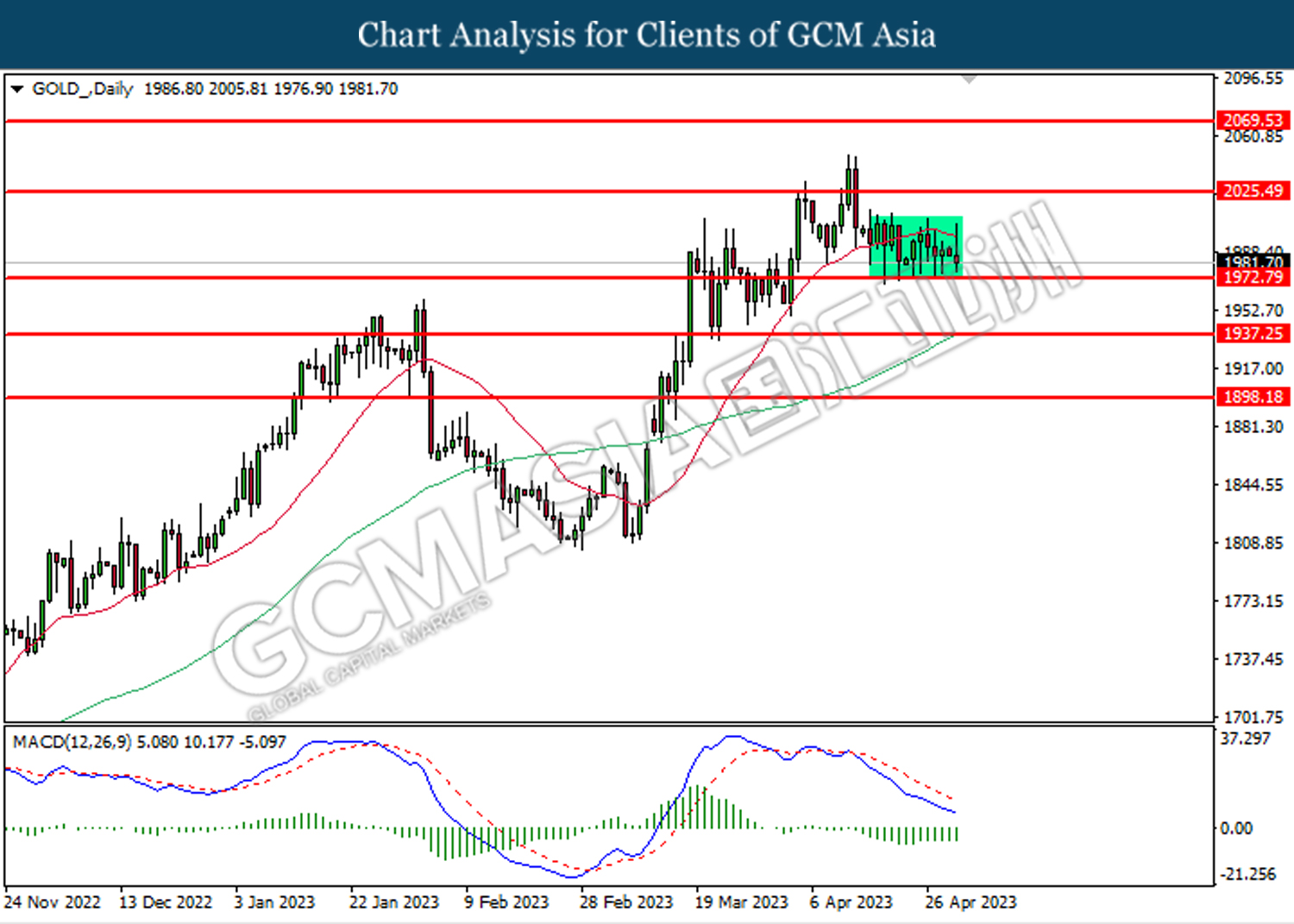

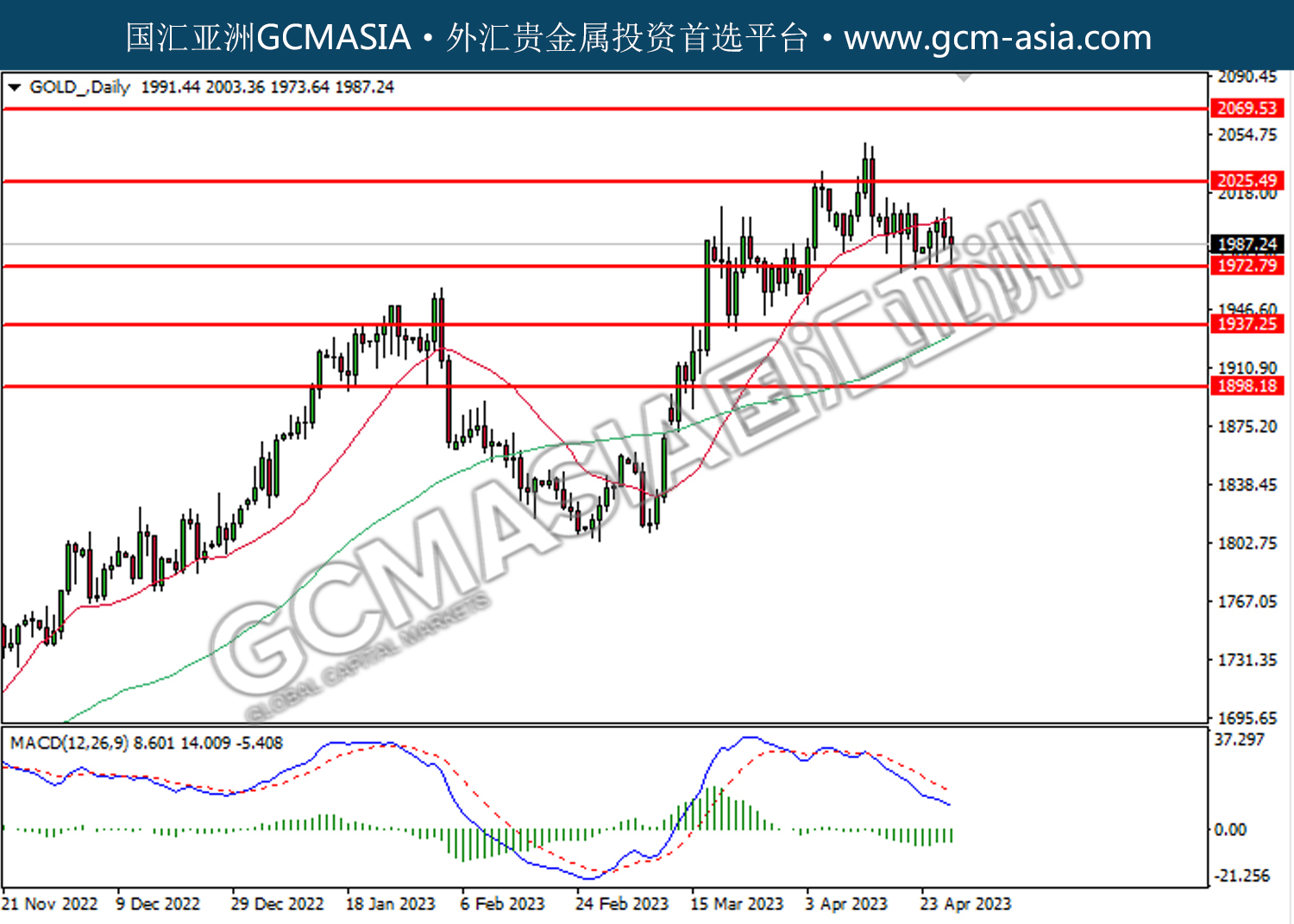

GOLD_, Daily: Gold price was traded higher while currently retesting the resistance level at 2025.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80

090523 Afternoon Session Analysis

9 May 2023 Afternoon Session Analysis

The Aussies traded sideway after mixed economic data announced。

The Australian dollar, one of the major traded currencies, was steady against the greenback after the mixed economic data was released during the Asian trading hours. Earlier in the day, the Australian Q1 retail sales shrank to -0.6% in line with market expectations, down from -0.3% in the previous reading. The recent data showed that Australian retails sales have fallen for the second straight quarter, a sign that high-interest rates and the high cost of living are effective and curb consumer spending. However, the retail sales in the month perspective are showing some signs of improvement. Monthly retail sales in March improved to 0.4% in line with market expectations, higher than the prior reading of 0.2%. The main attributes of the growth came from food retail and restaurant service which increase by 1.0% and 1.5% respectively. Apart from the mixed monthly retail sales data, the pair of AUDUSD also bear the burden of caution sentiment over China’s import and export economic data, as China is Australia’s second-largest trading partner. China’s April trade balance was recorded at $ 90.21 billion versus $71.60 billion expectations and $88.19 billion. The trade balance surplus amid exports in the country surged as the export grew by 8.5% vs 8.0% expectations and imports shrank -7.9% vs -5.0%. It is worth mentioning that China’s exports and imports both declined in April, with the previous readings of exports and imports being 14.8% and -4.1% respectively. Therefore, the pair of AUD/USD continues its slideway trend. As of writing, the AUDUSD teeters by -0.15% to $0.6775 as investors eye on US debt ceiling issues.

In the commodities market, crude oil prices are down by -0.83% to $72.56 per barrel after China imports data showing some softening in demands. Besides, gold prices ticked up by 0.10% to $2023.47 per troy ounce as investors await US inflation data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

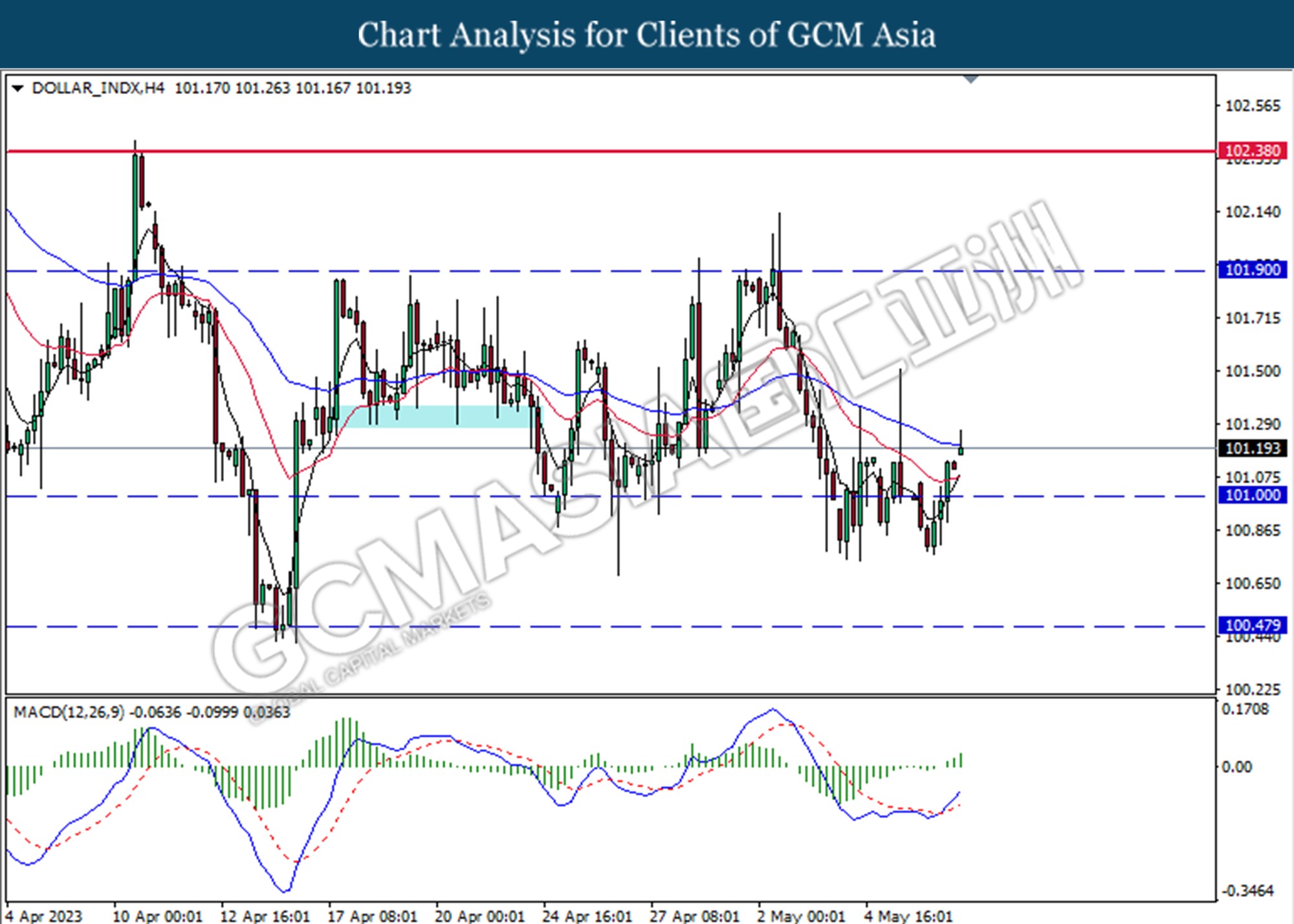

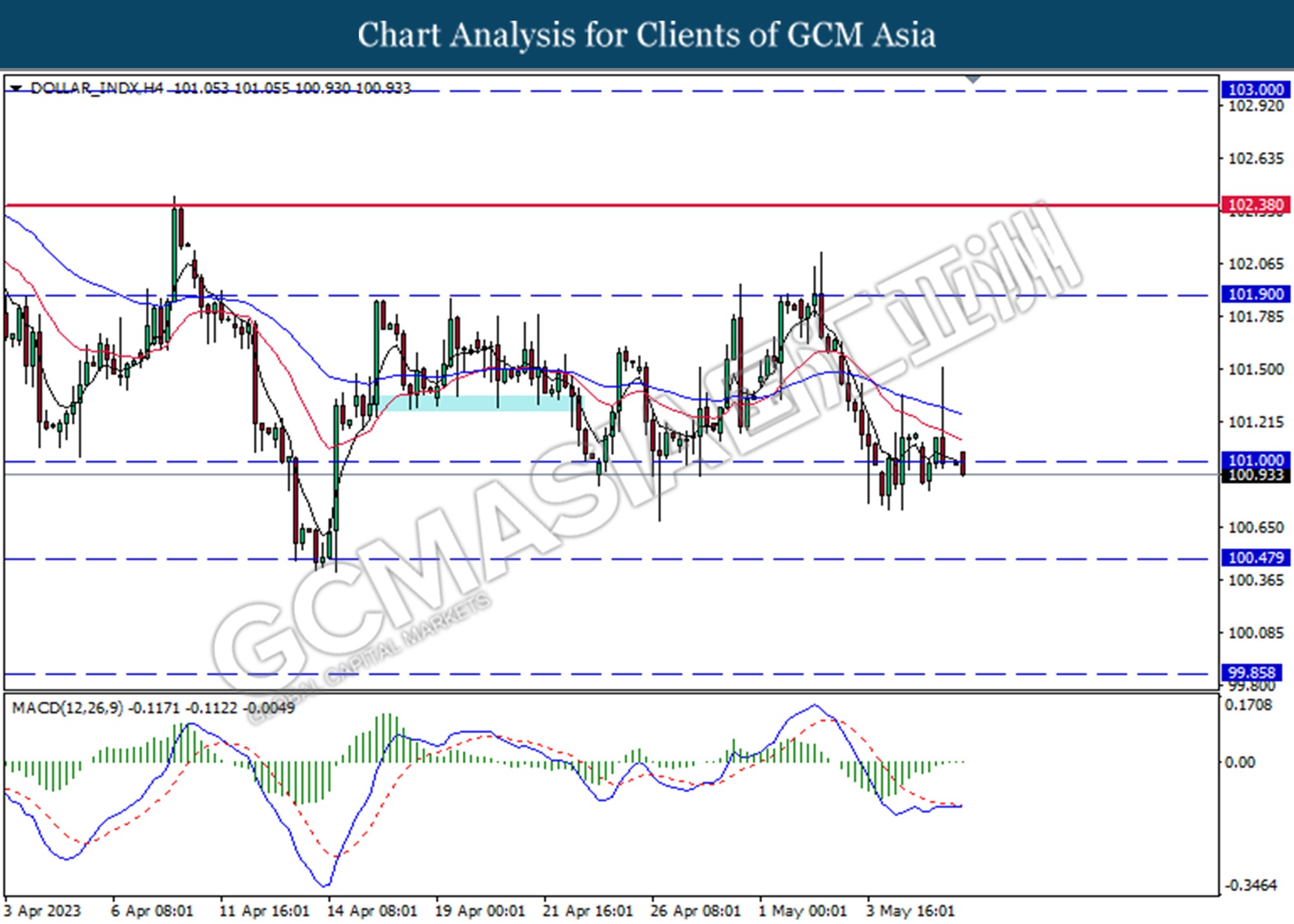

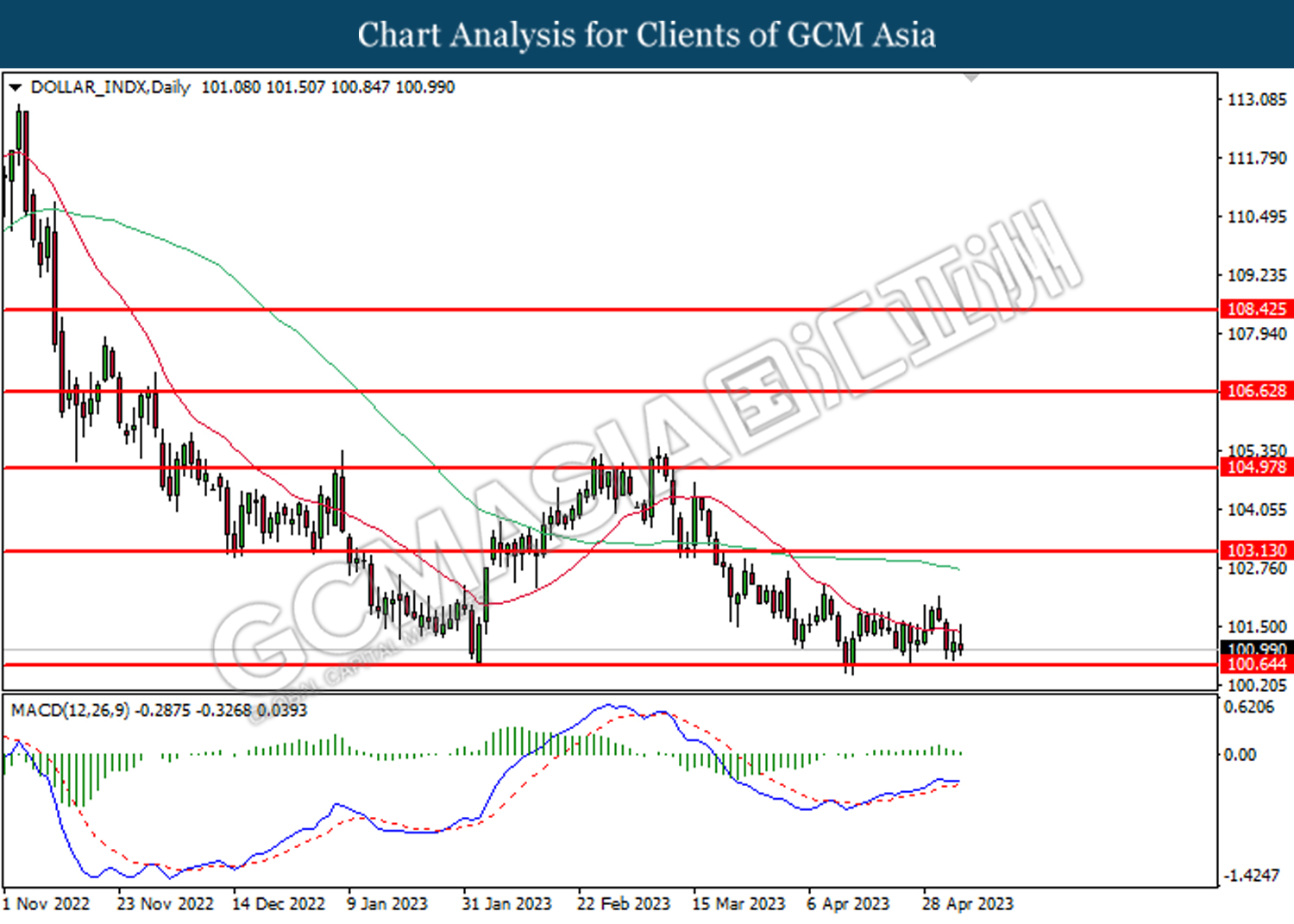

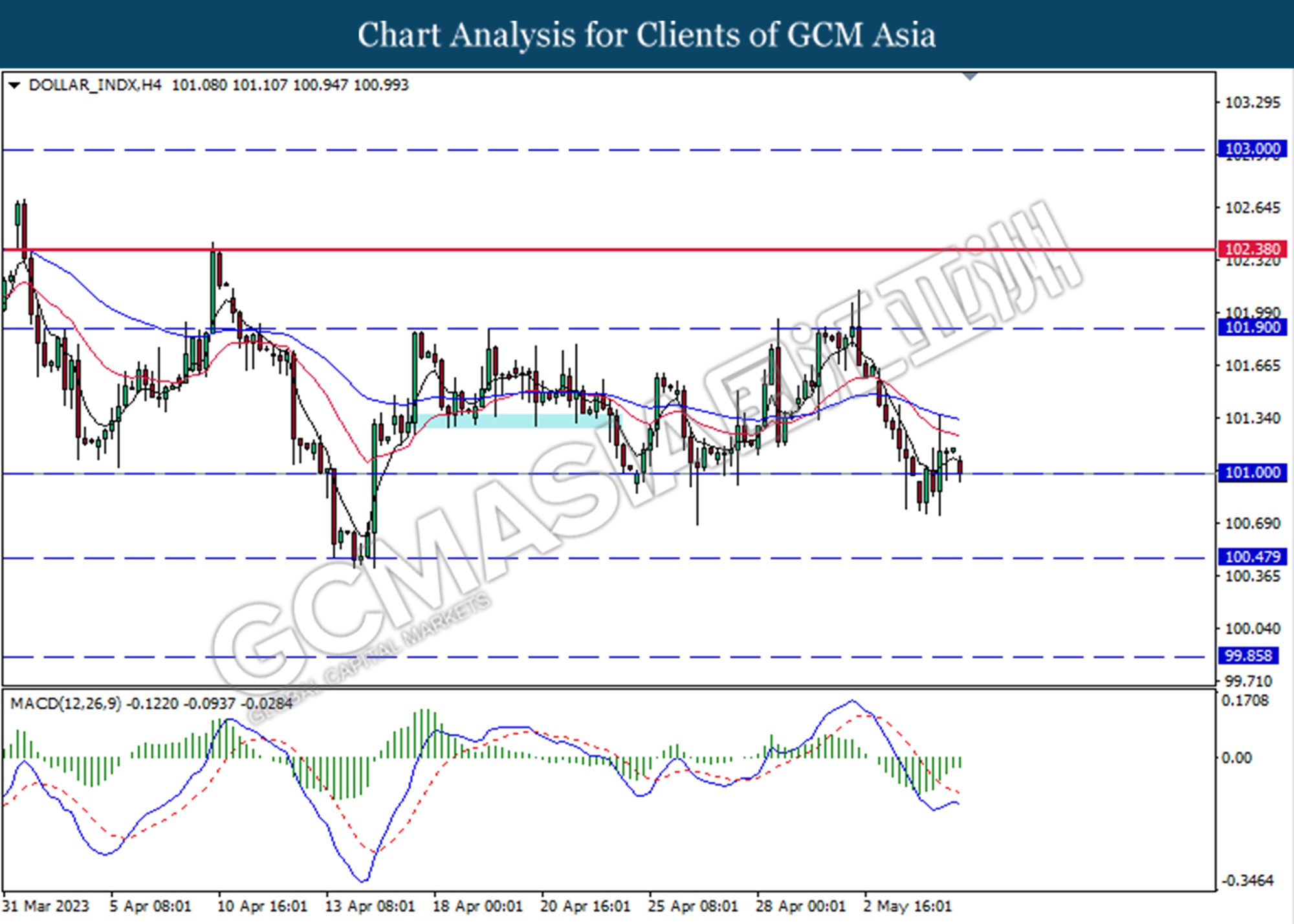

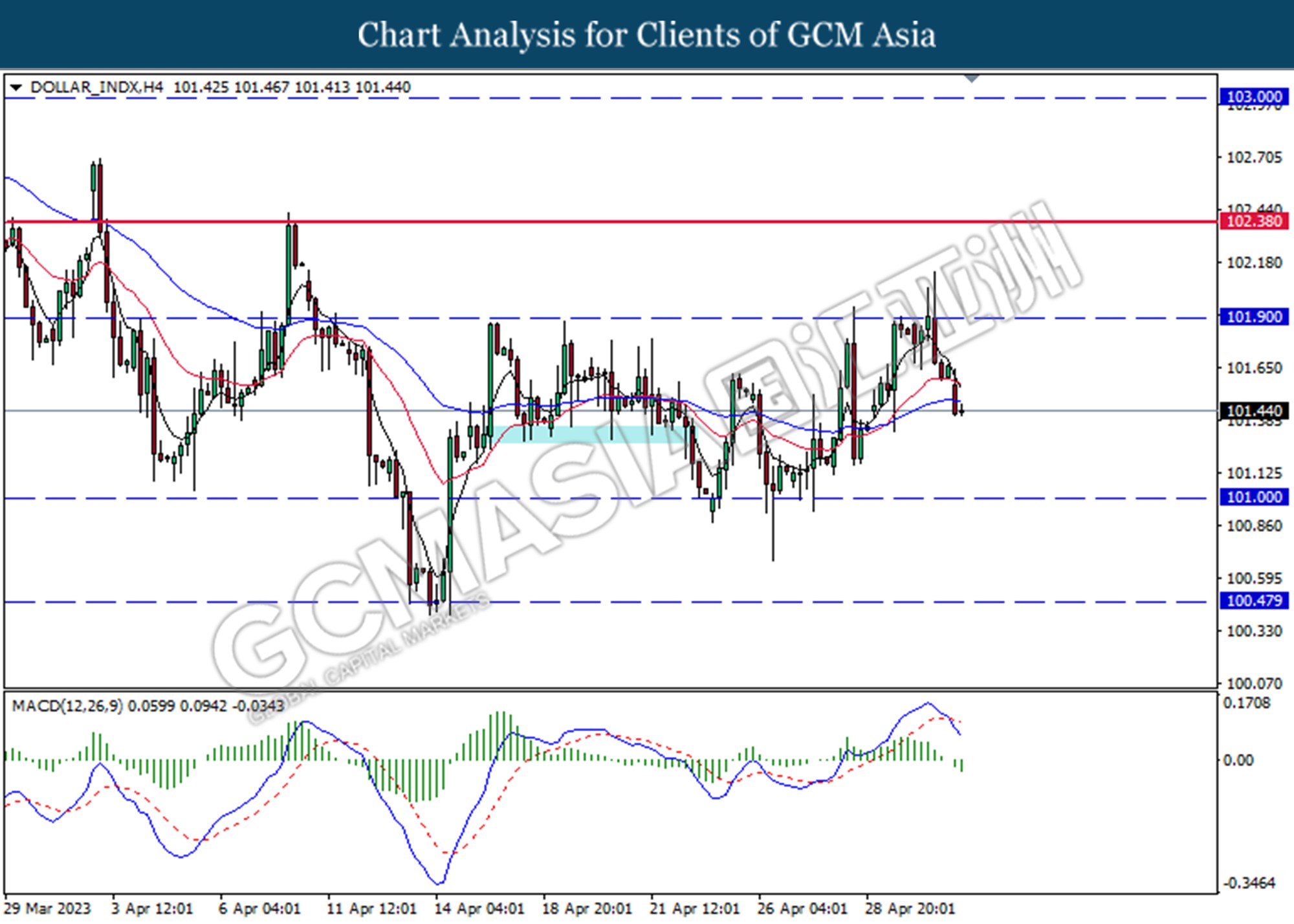

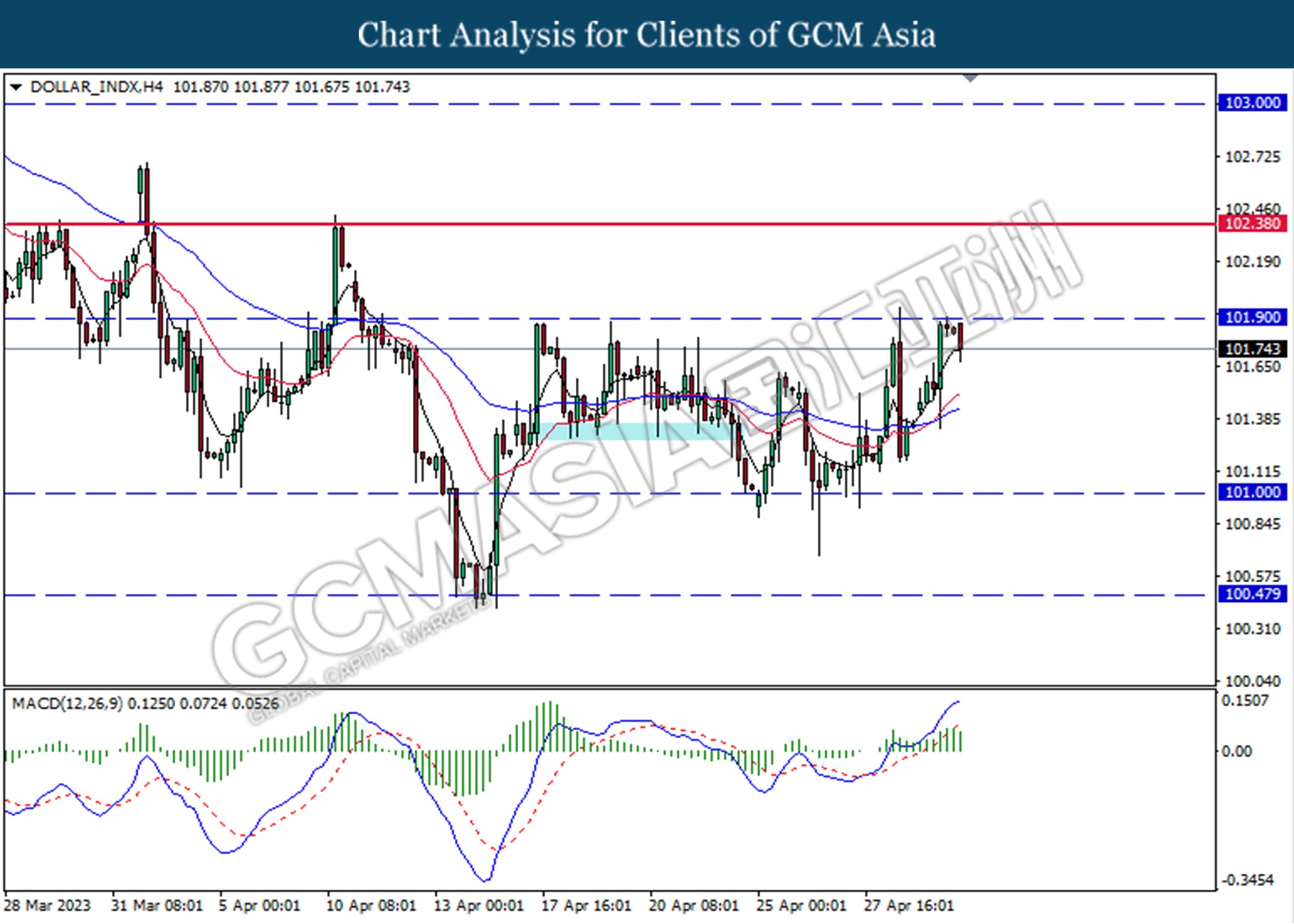

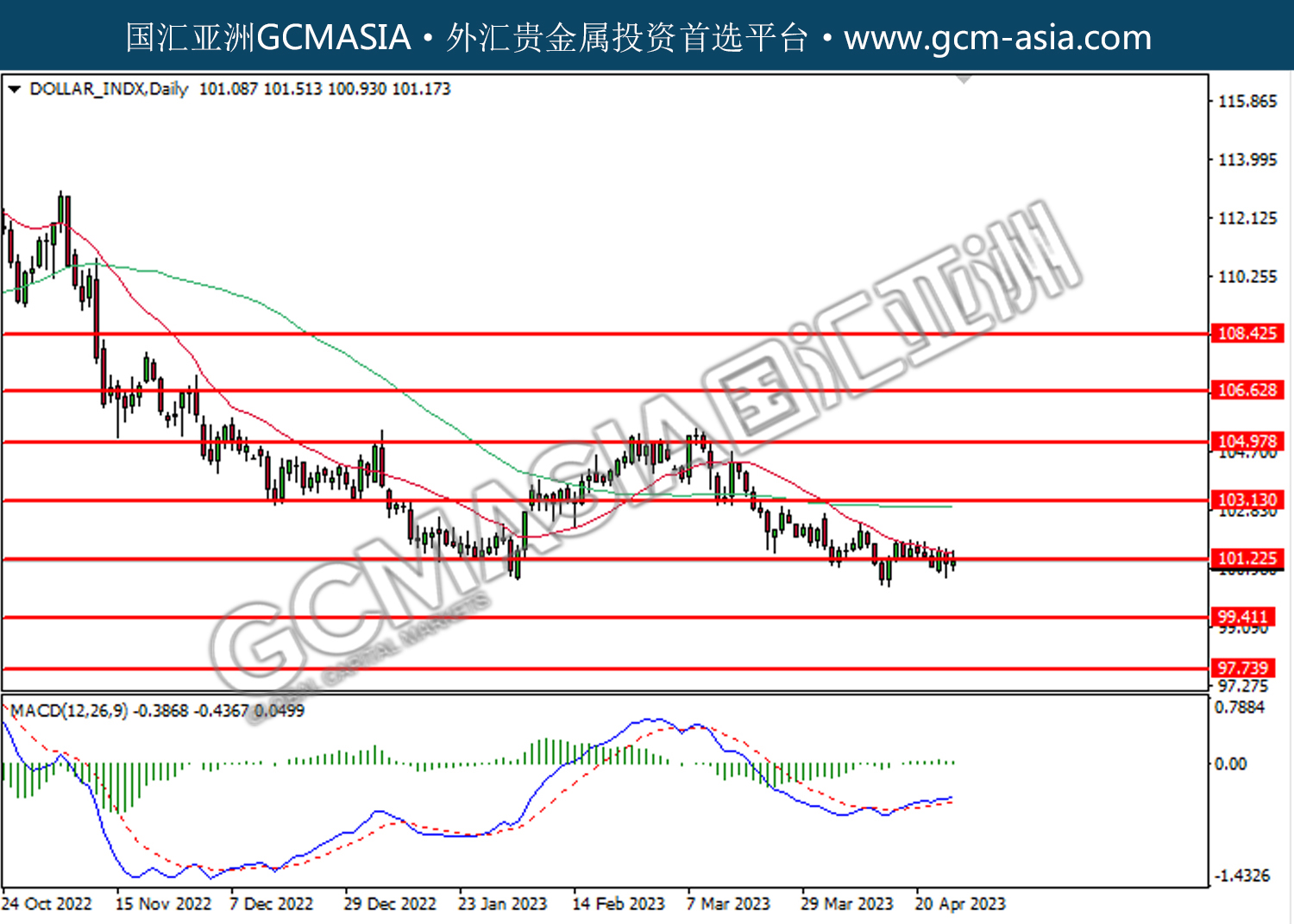

DOLLAR_INDX, H4: Dollar index was traded higher following a prior break above the previous resistance level at 101.00. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

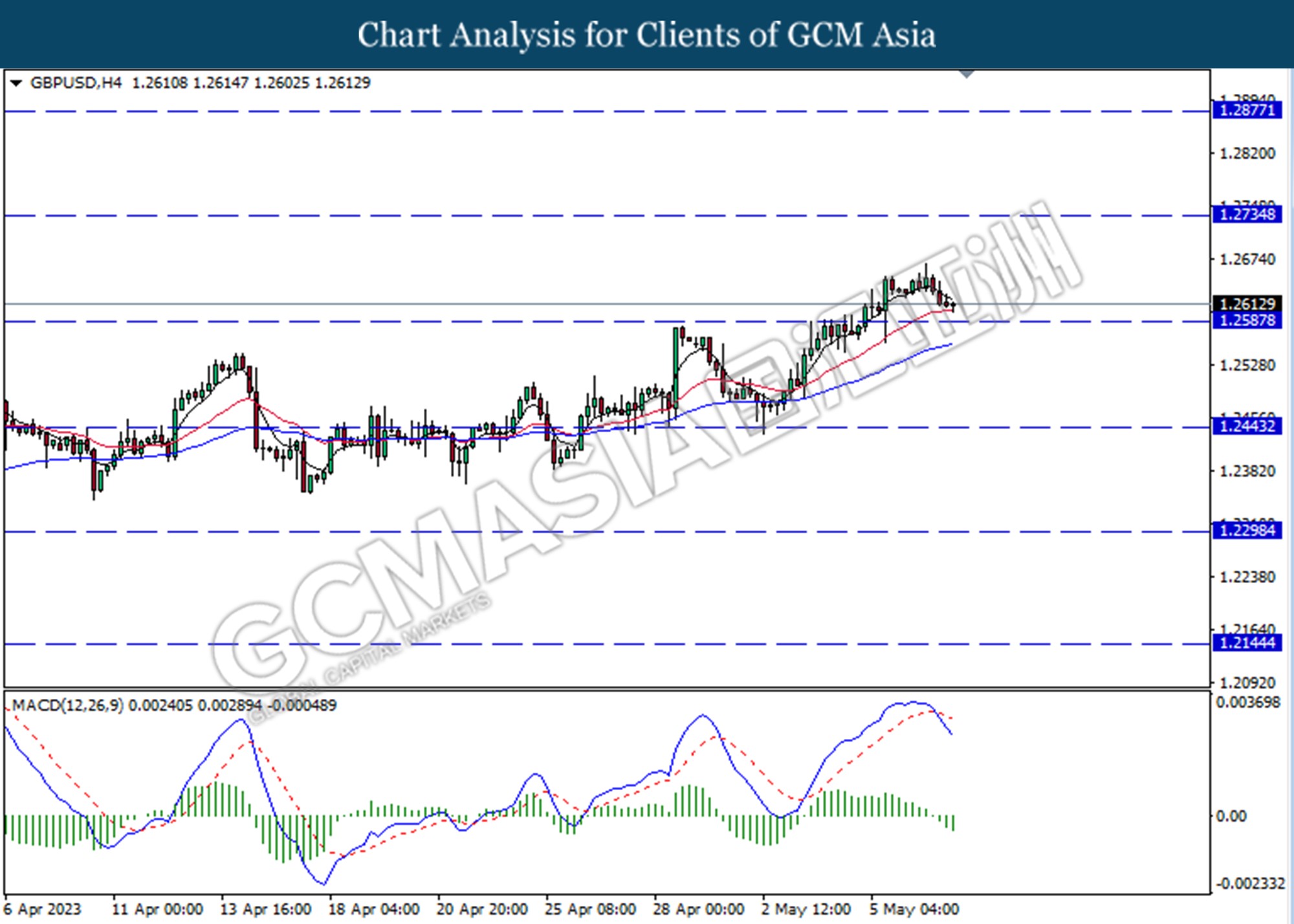

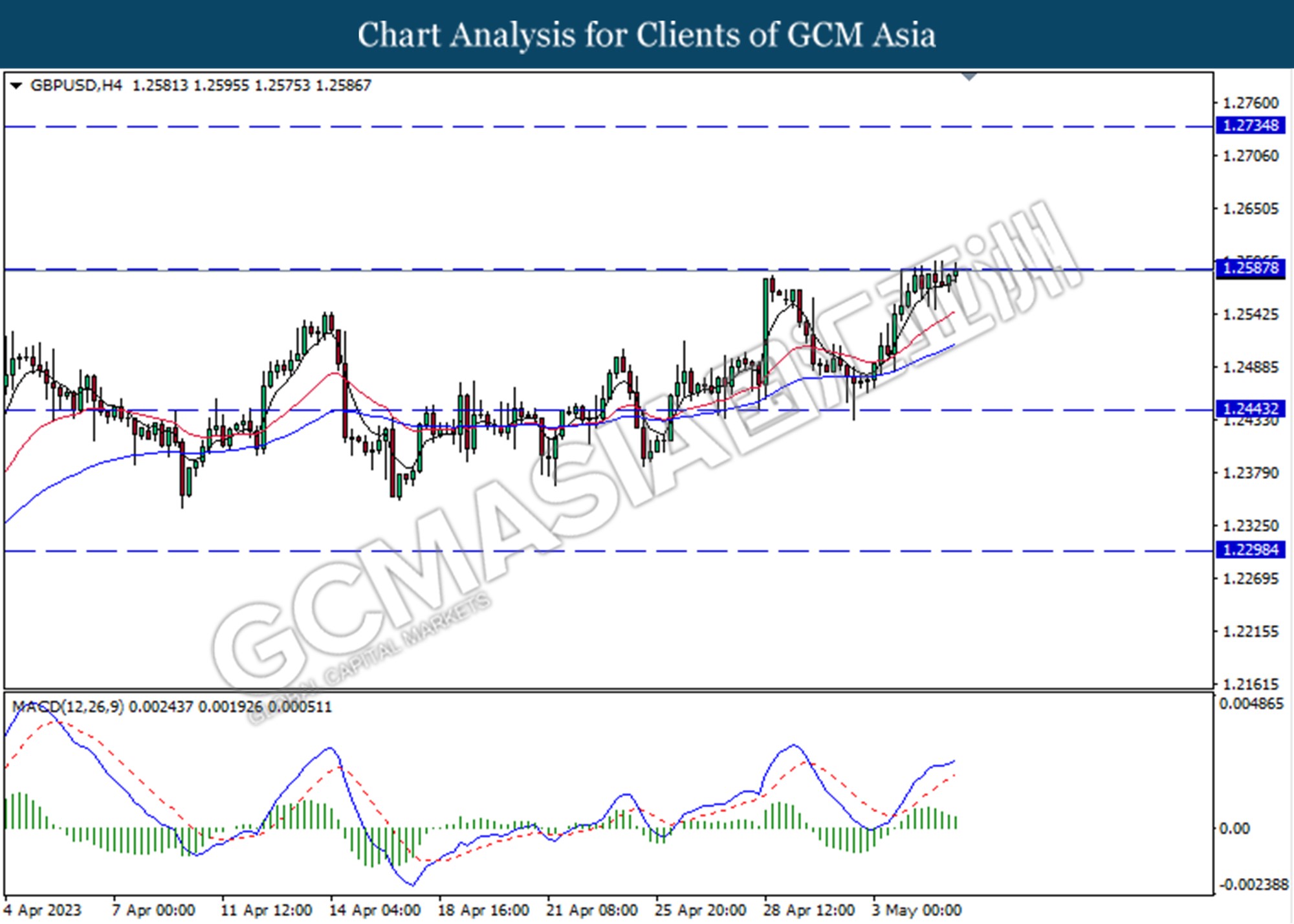

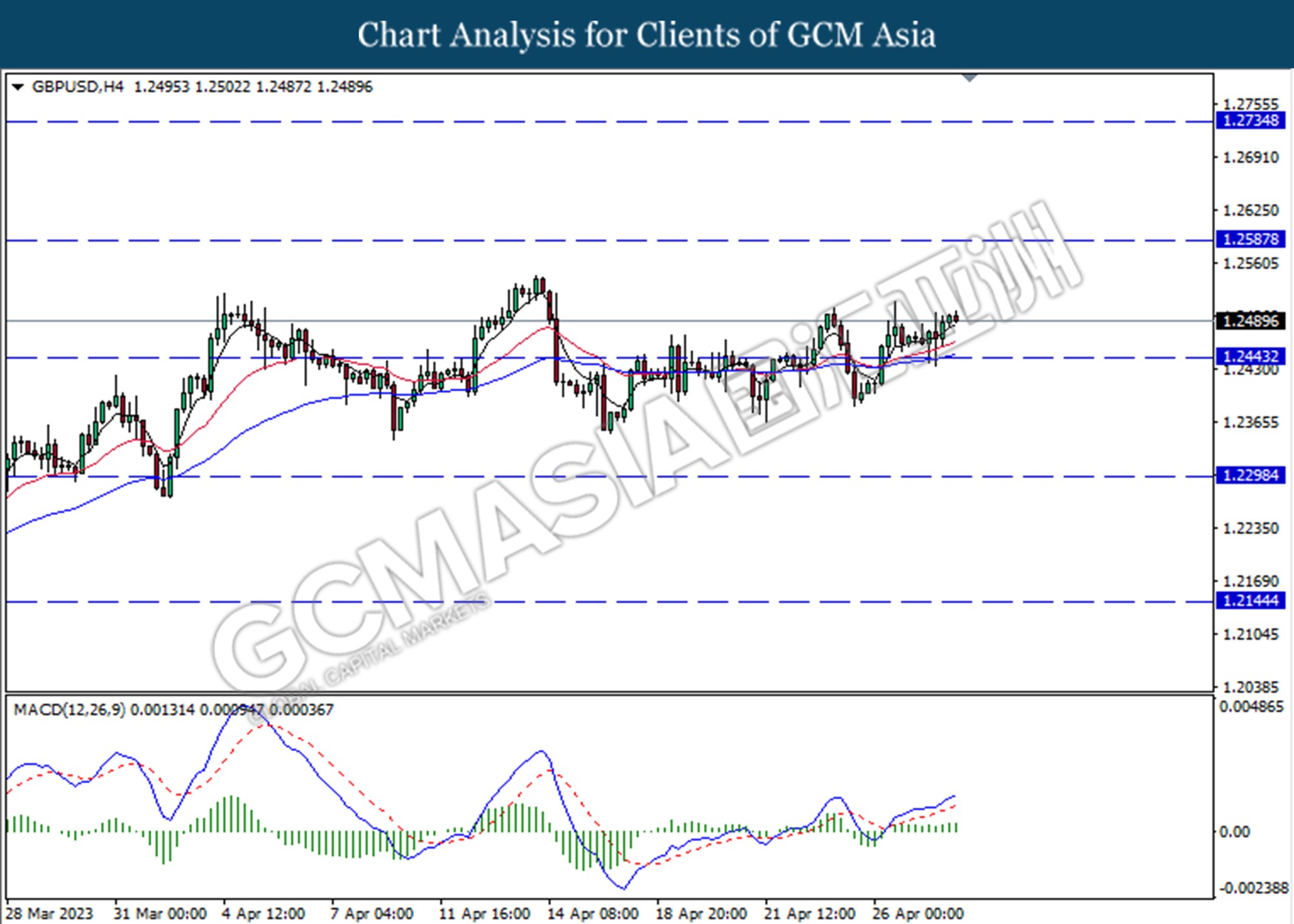

GBPUSD, H4: GBPUSD was traded lower while following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2600.

Resistance level: 1.2735, 1.2880

Support level: 1.2600, 1.2445

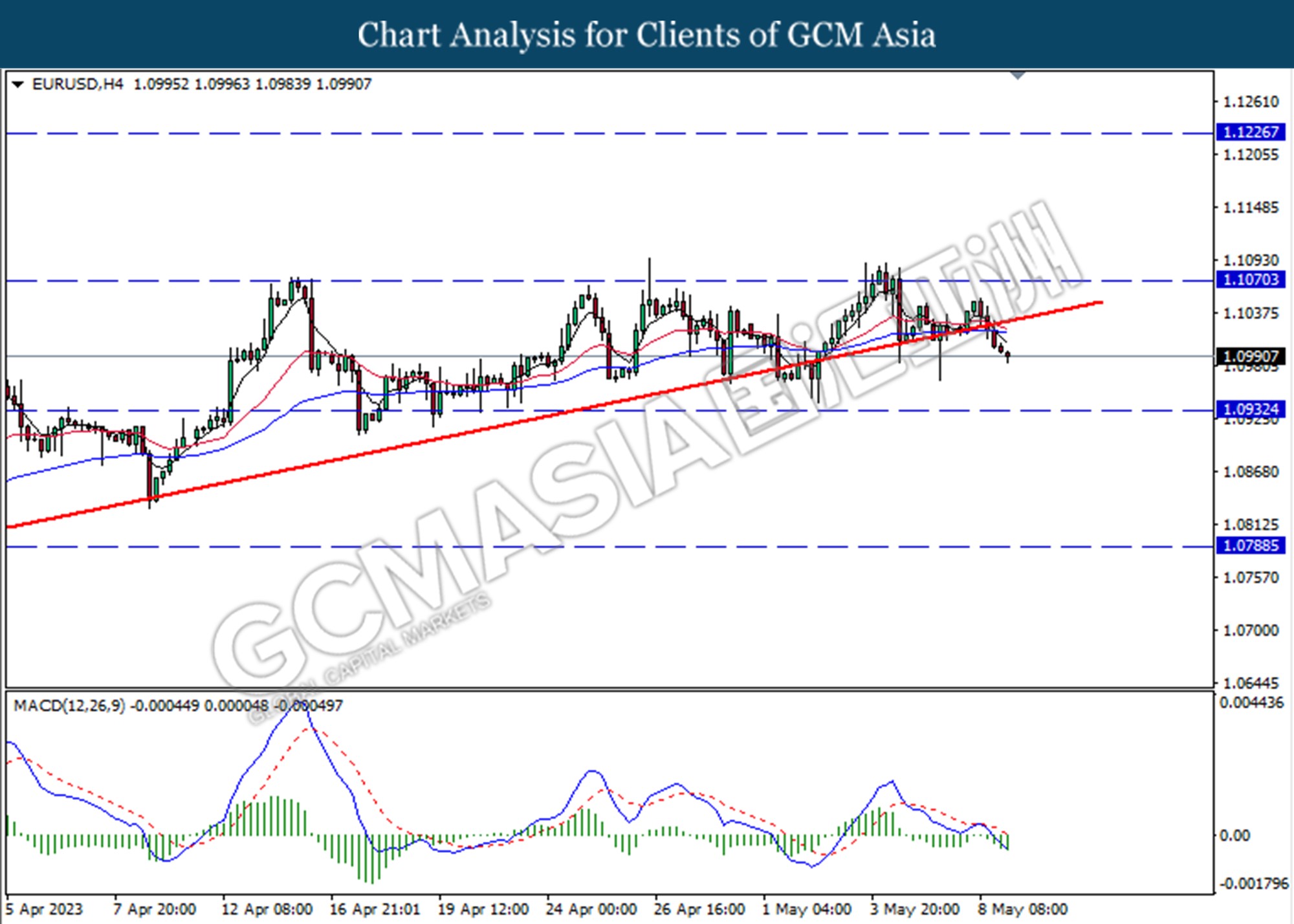

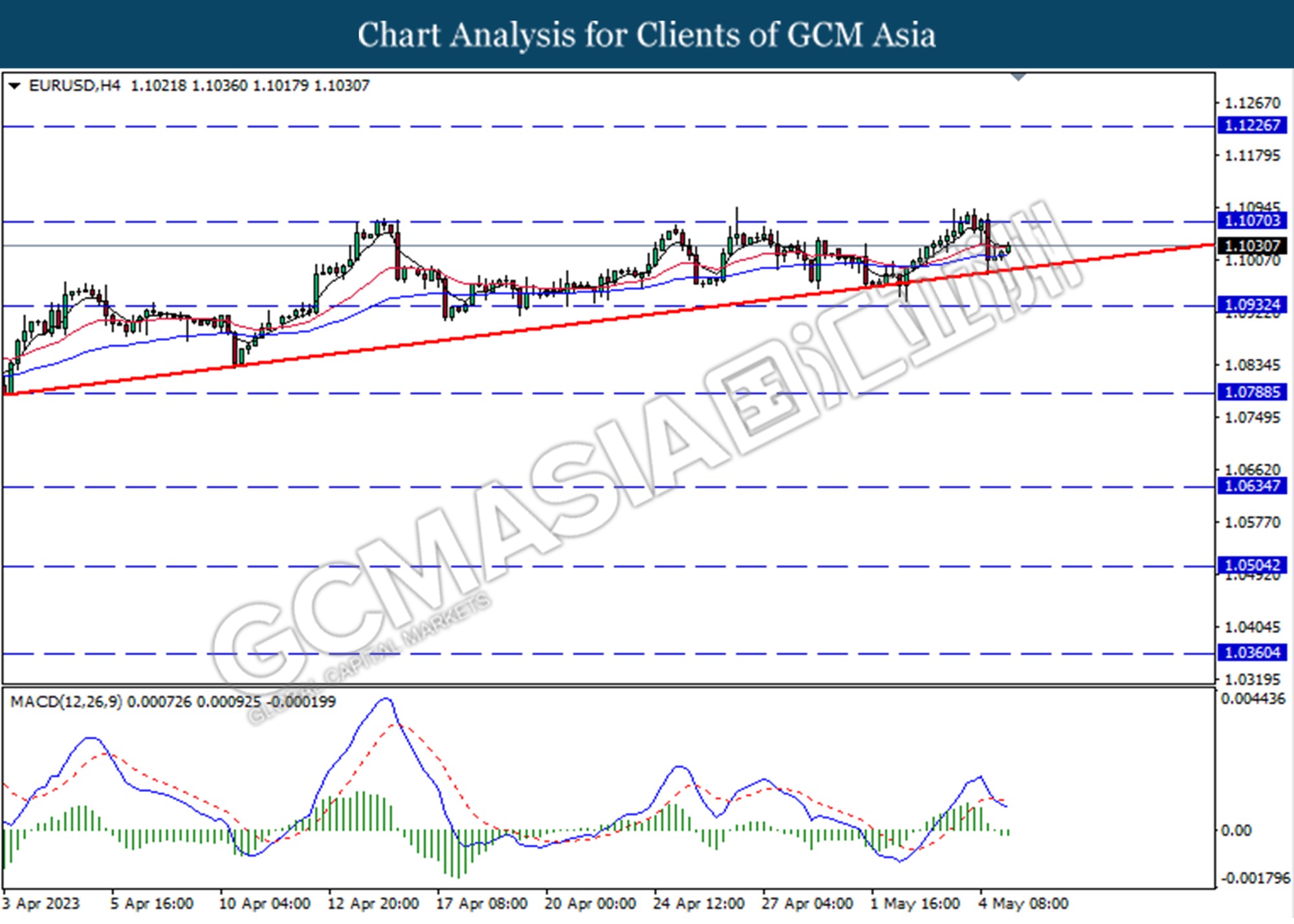

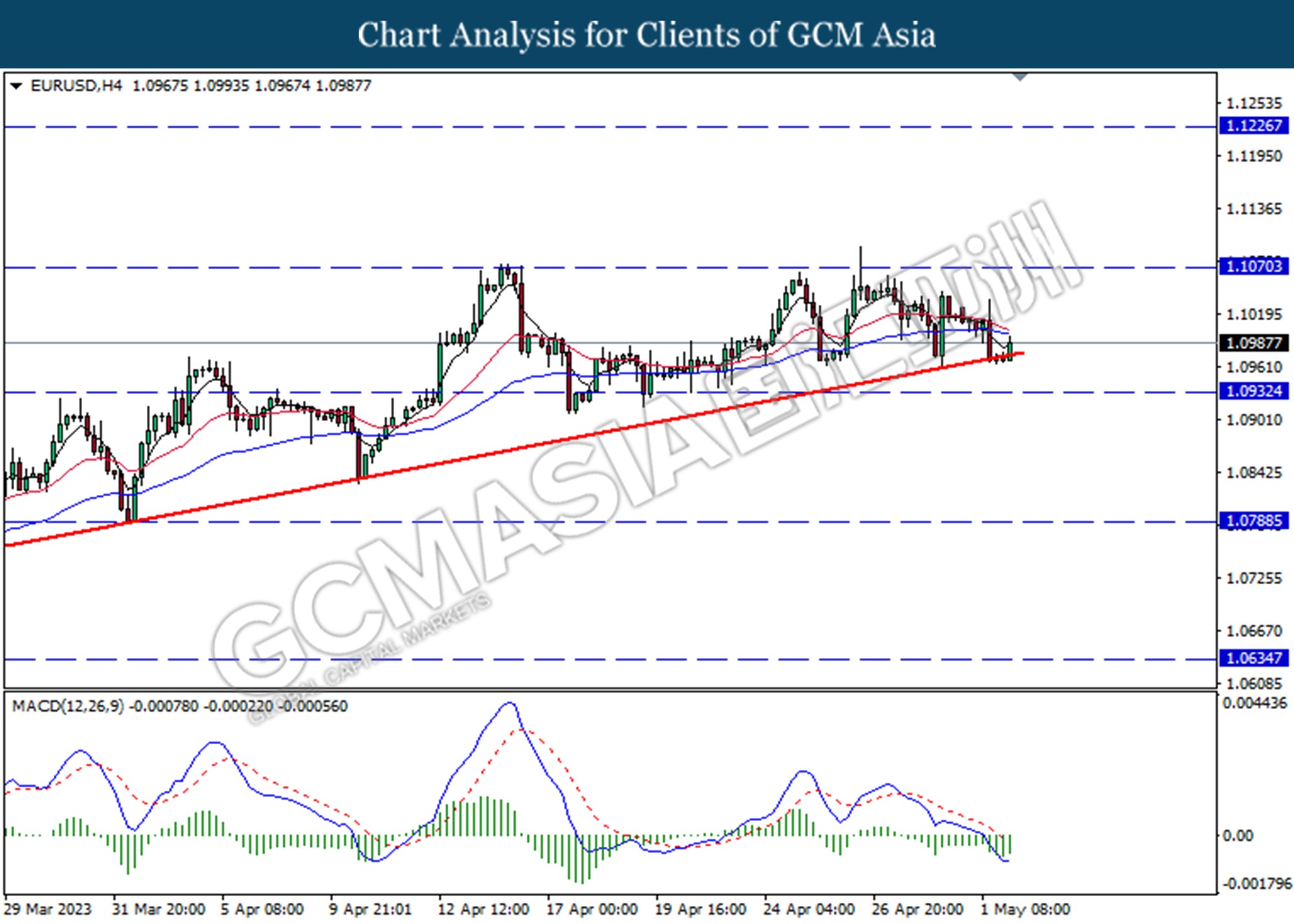

EURUSD, H4: EURUSD was traded lower following a prior break below the upward trend line. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0935.

Resistance level: 1.1070, 1.1225

Support level: 1.0935, 1.0790

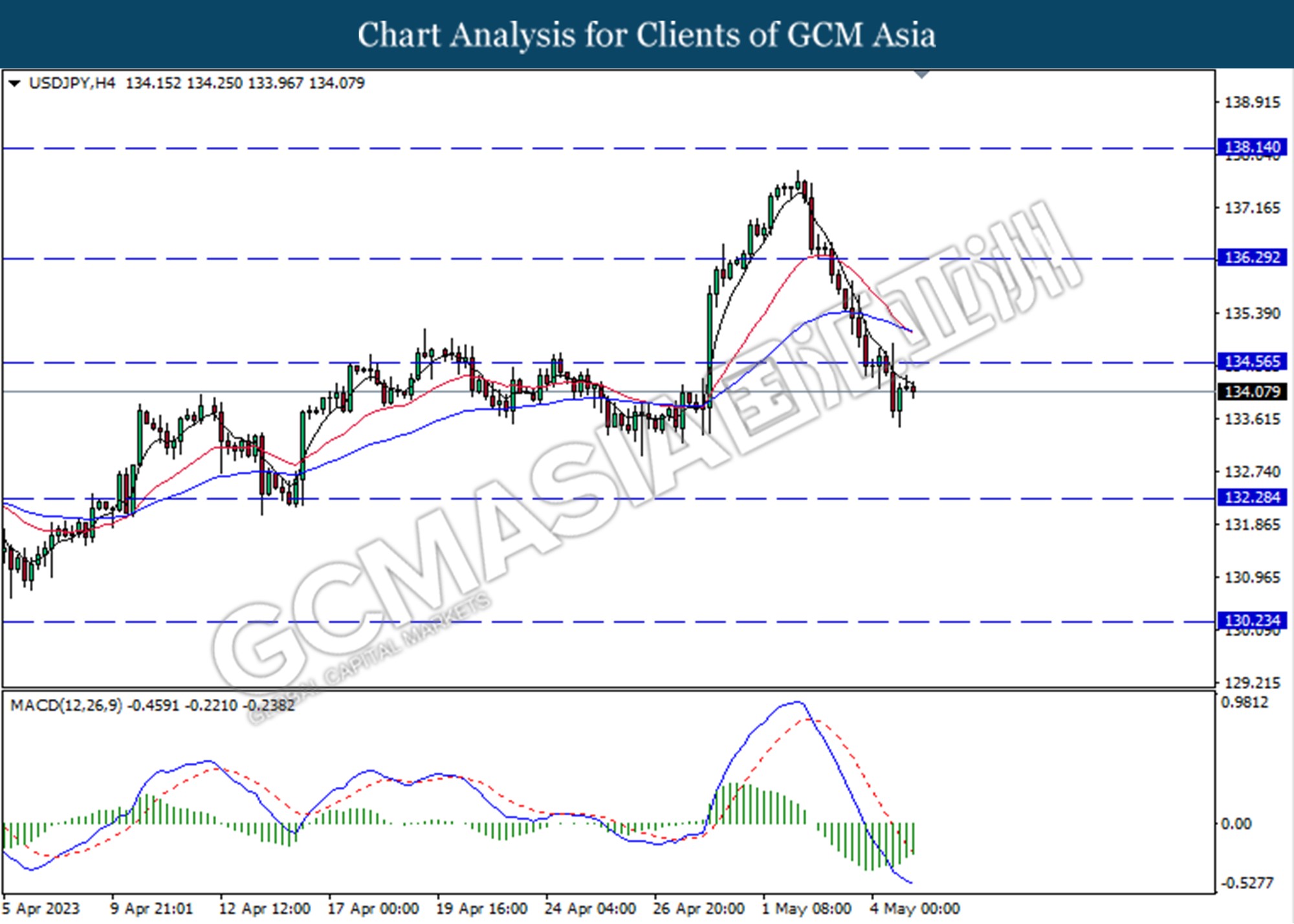

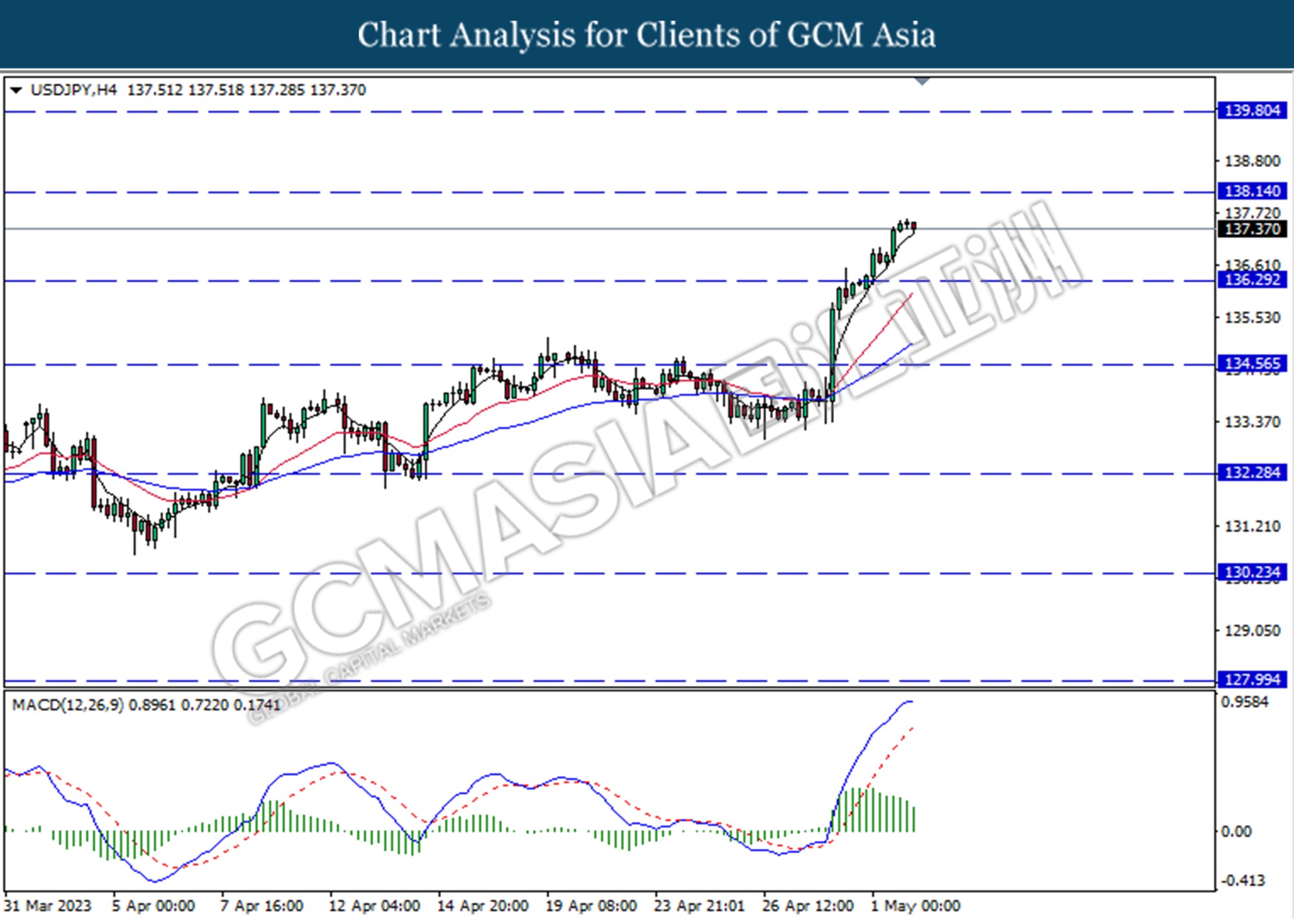

USDJPY, H4: USDJPY was traded higher following a prior rebound from the support level at 134.55. MACD which illustrated bias momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

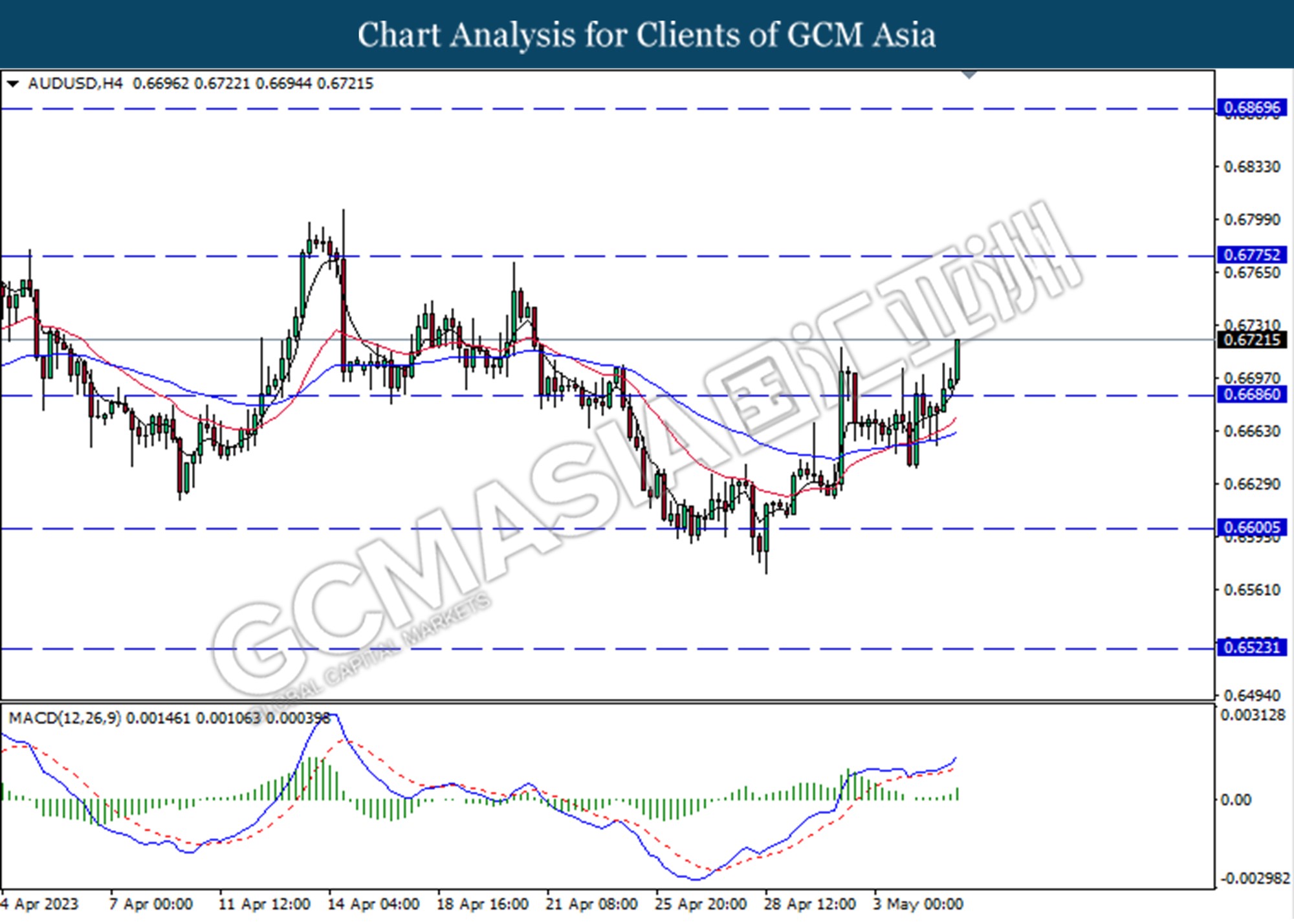

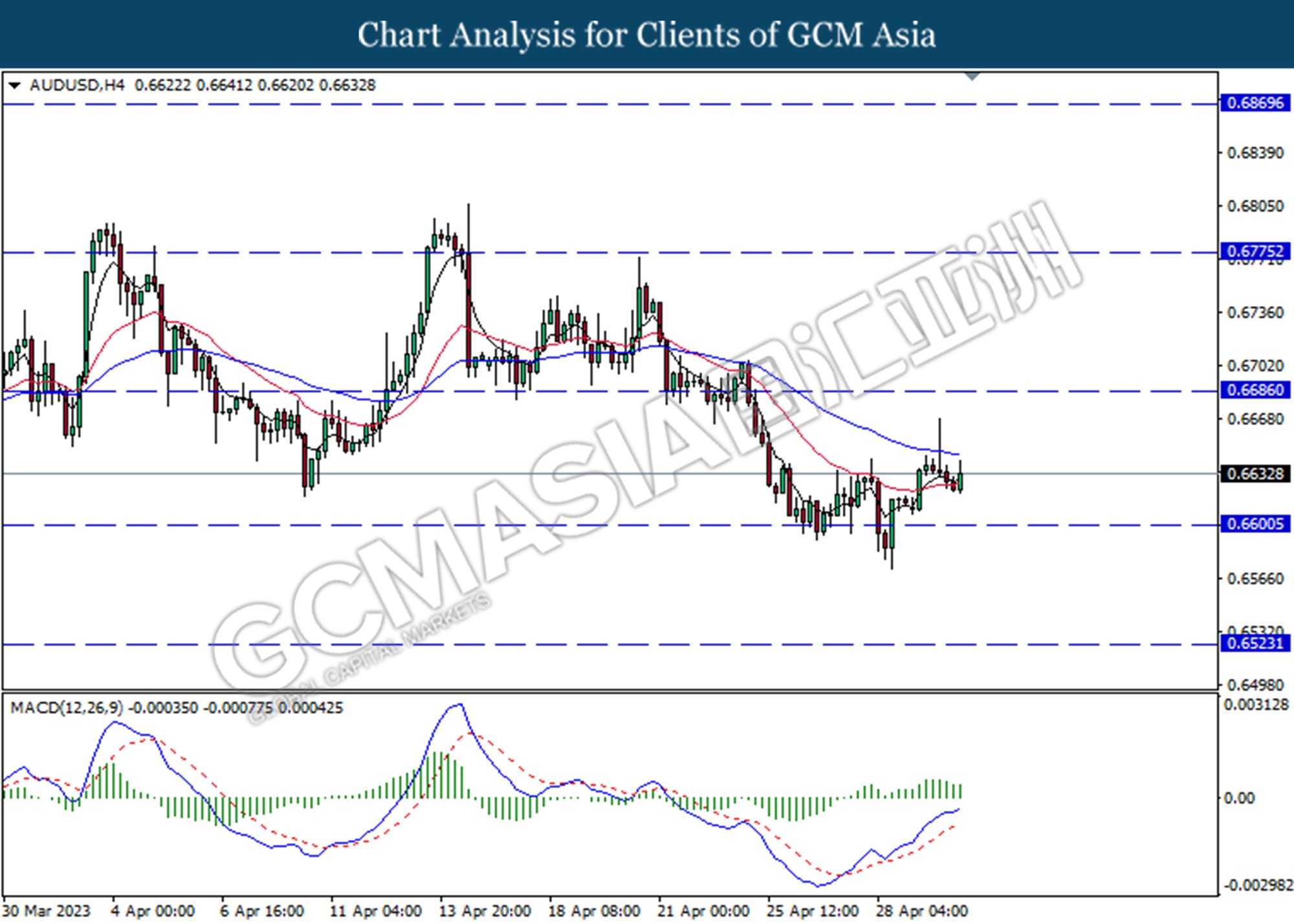

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6775. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 0.6325.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

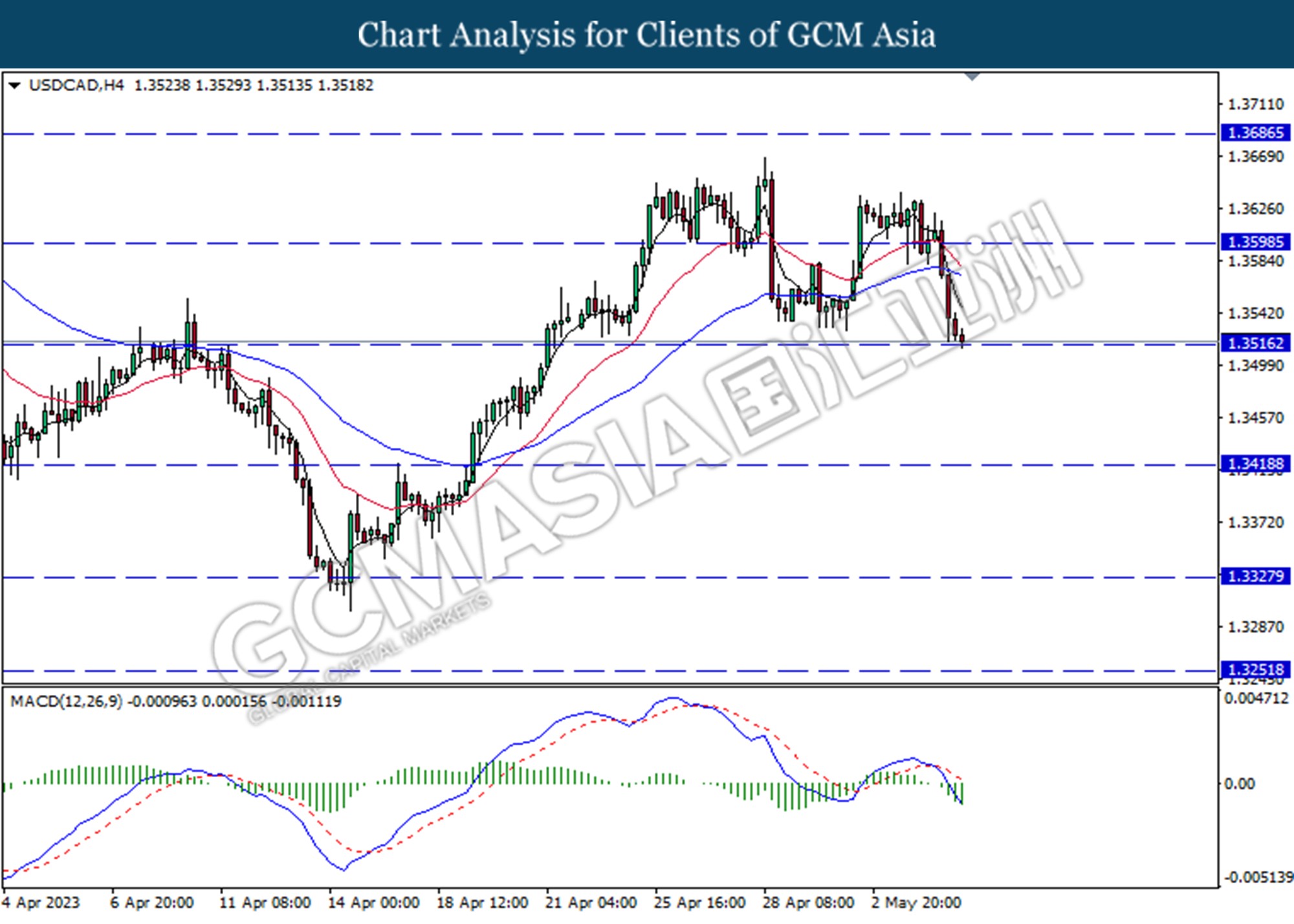

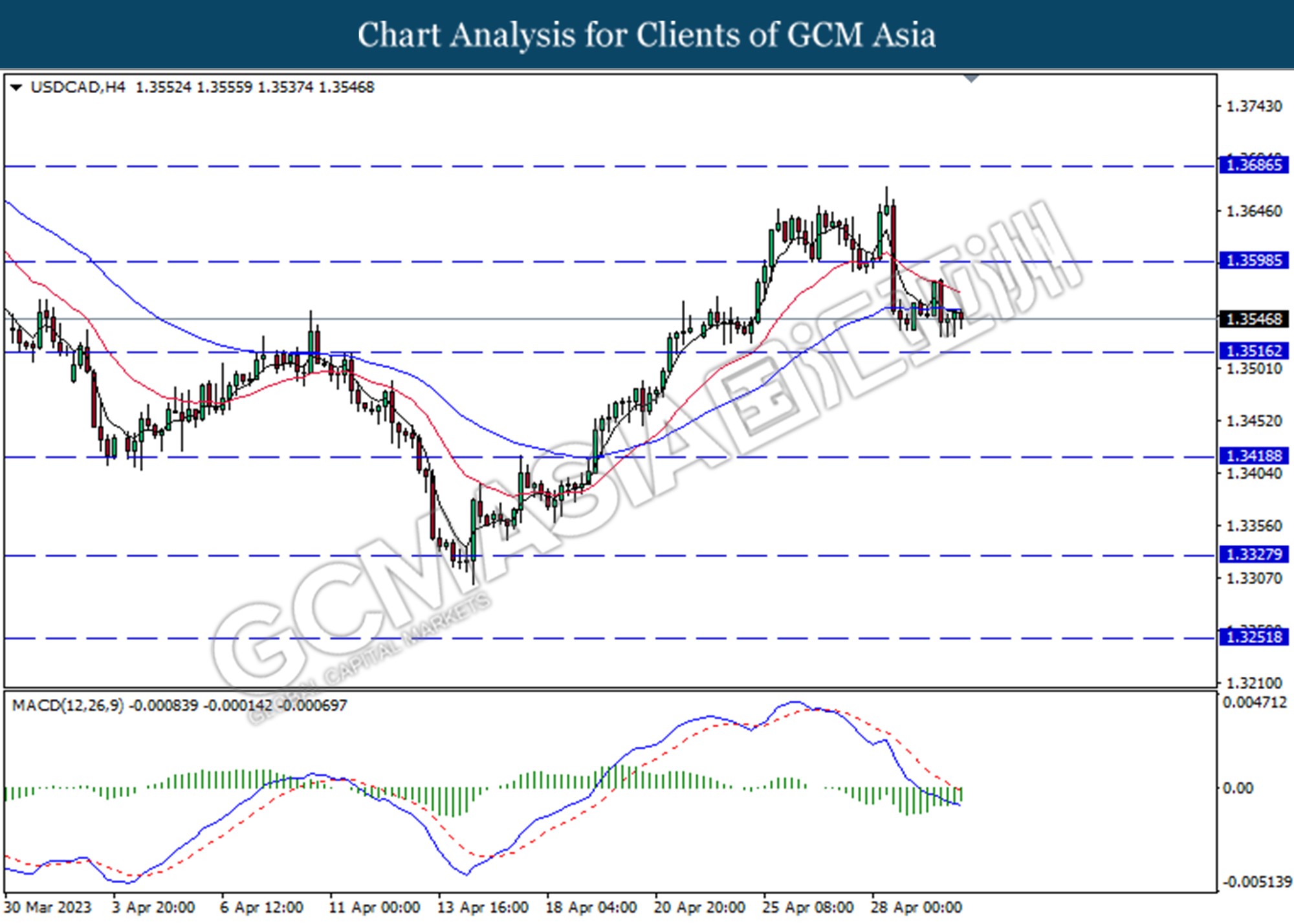

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3330. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

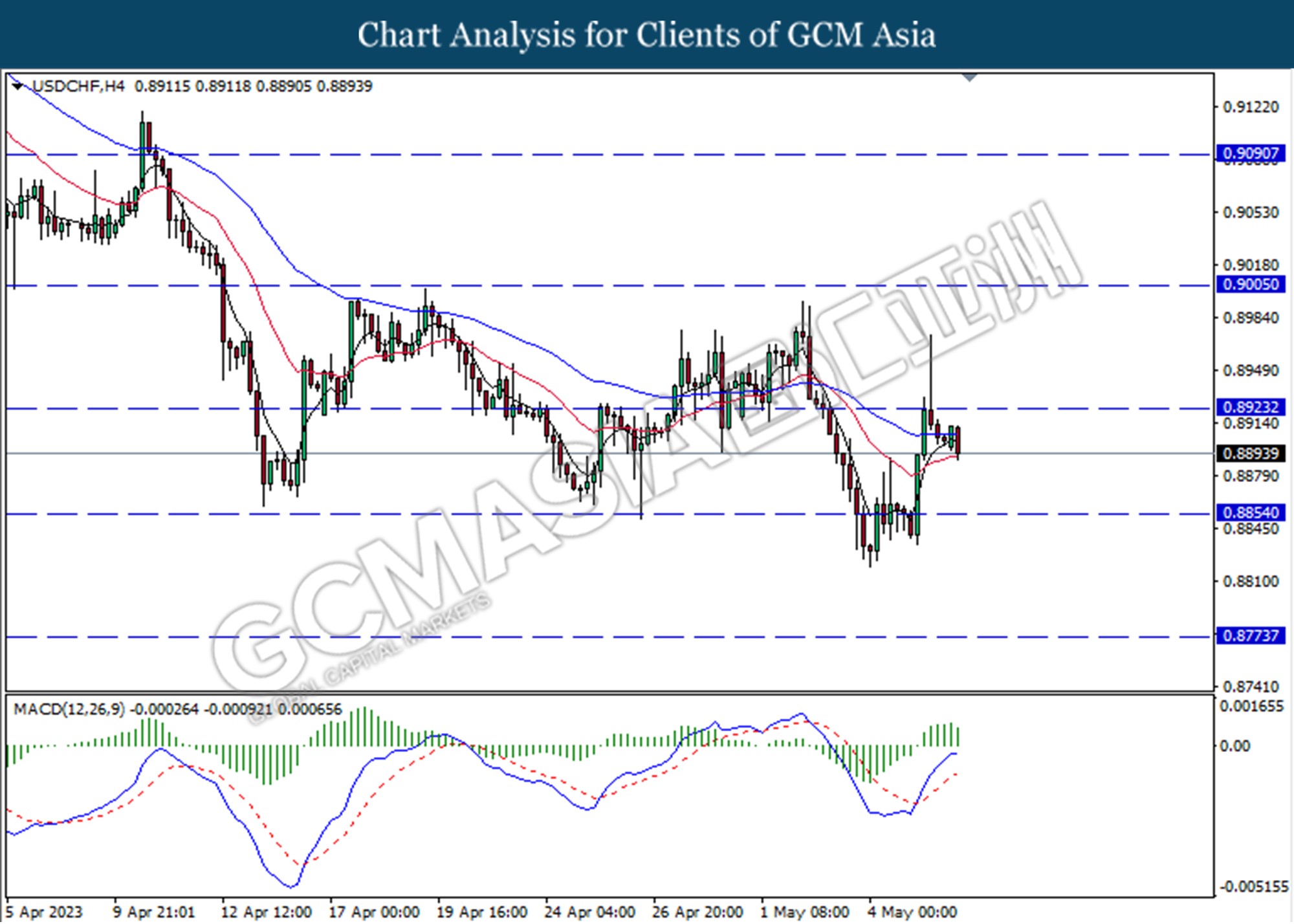

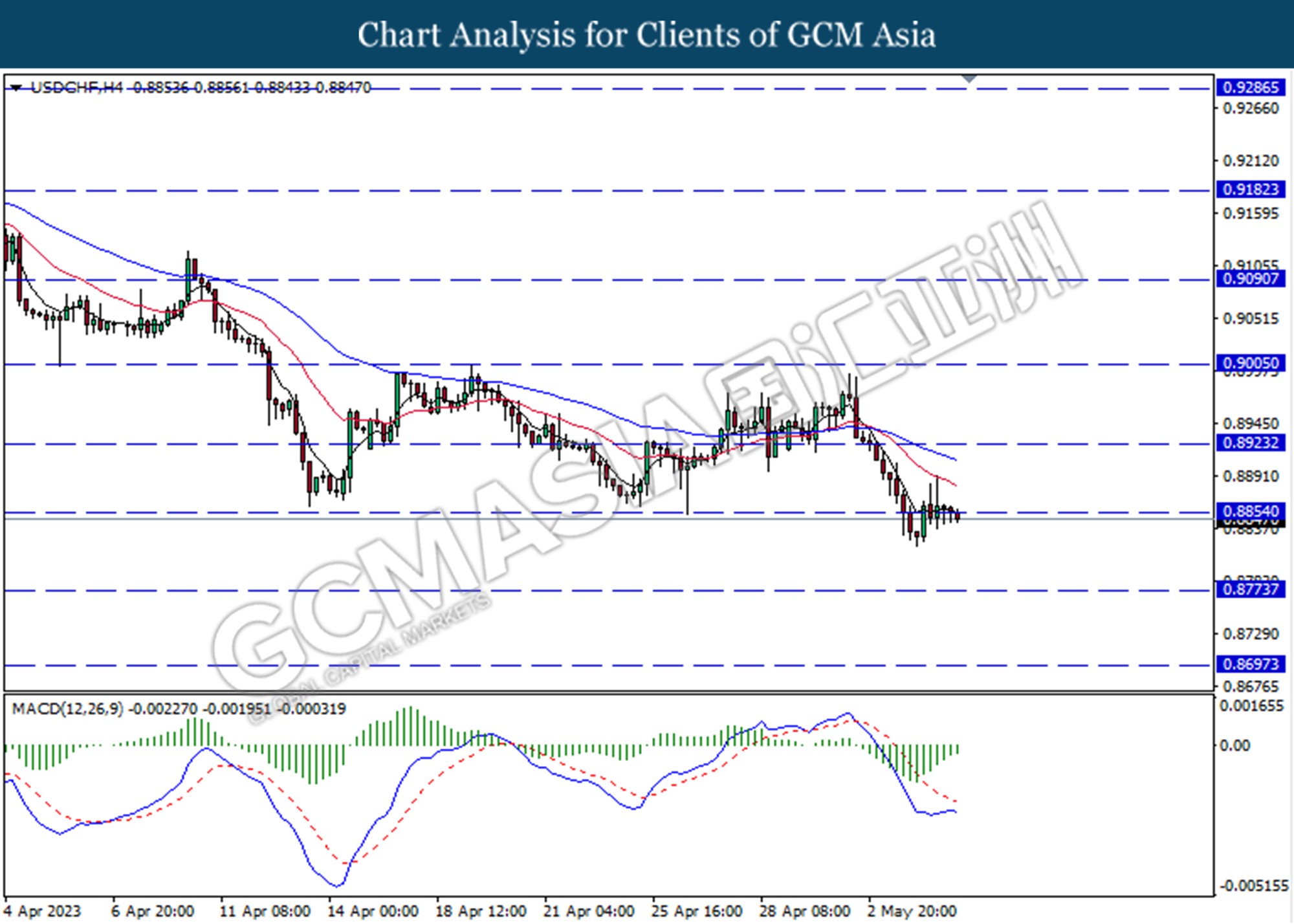

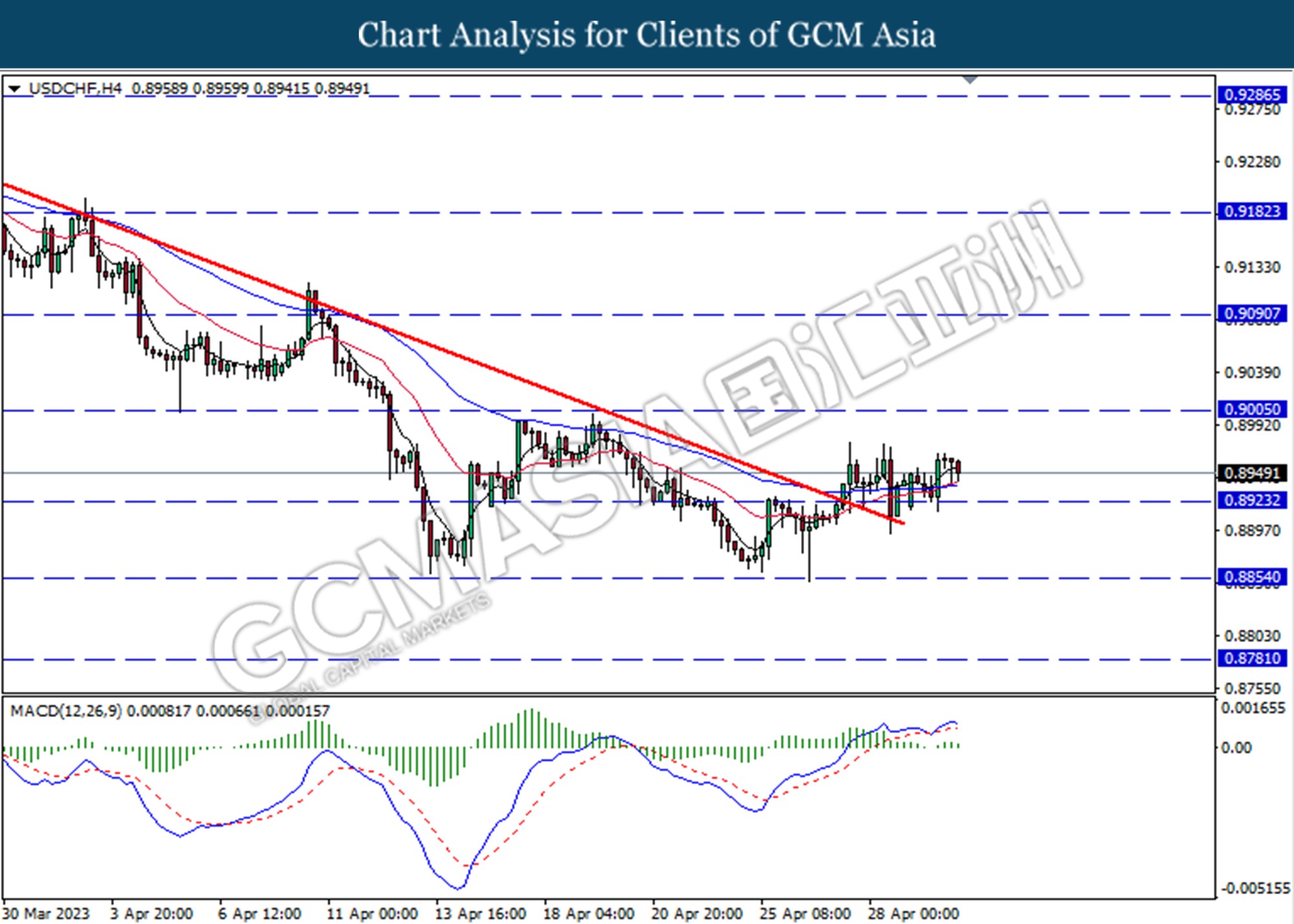

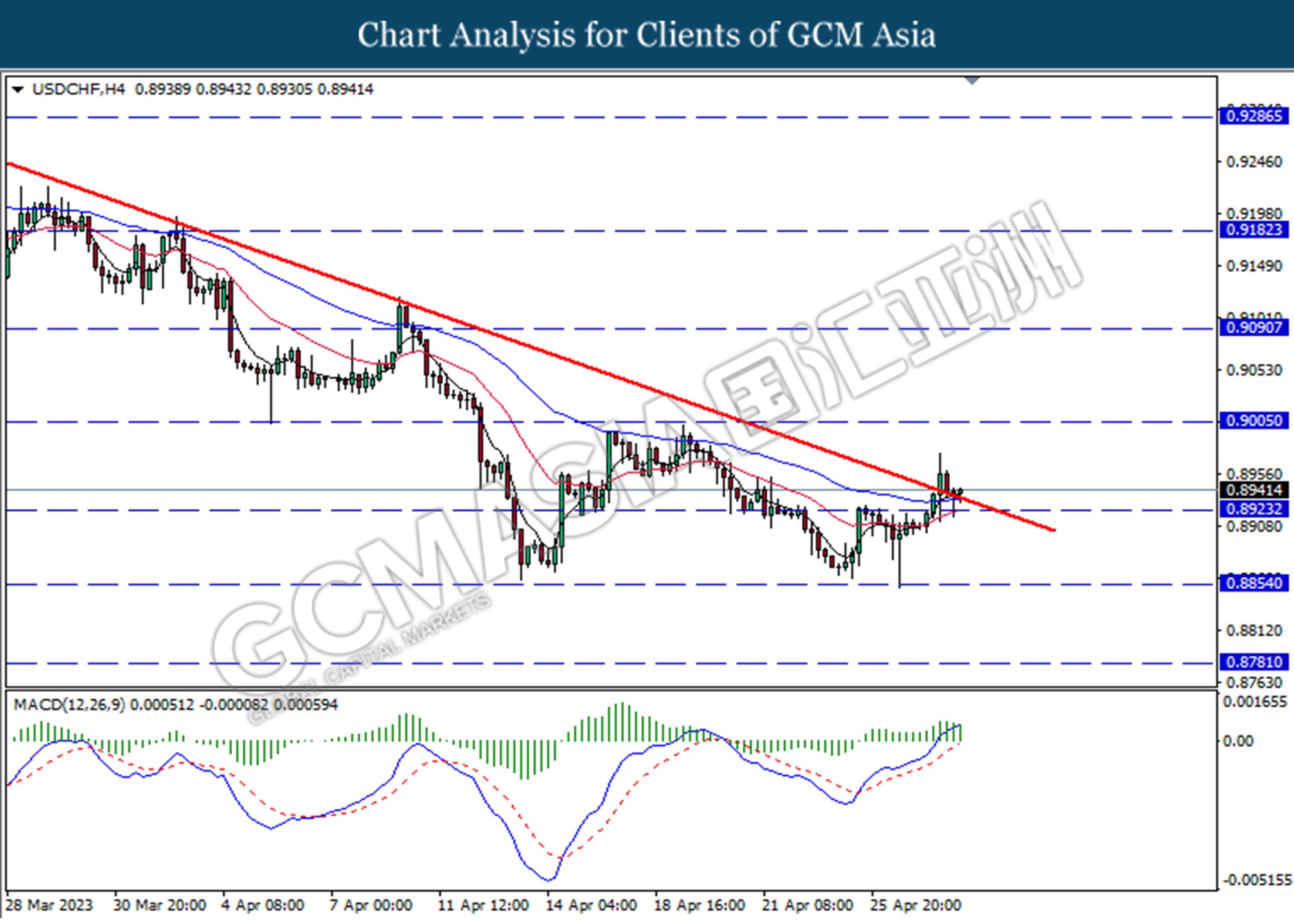

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

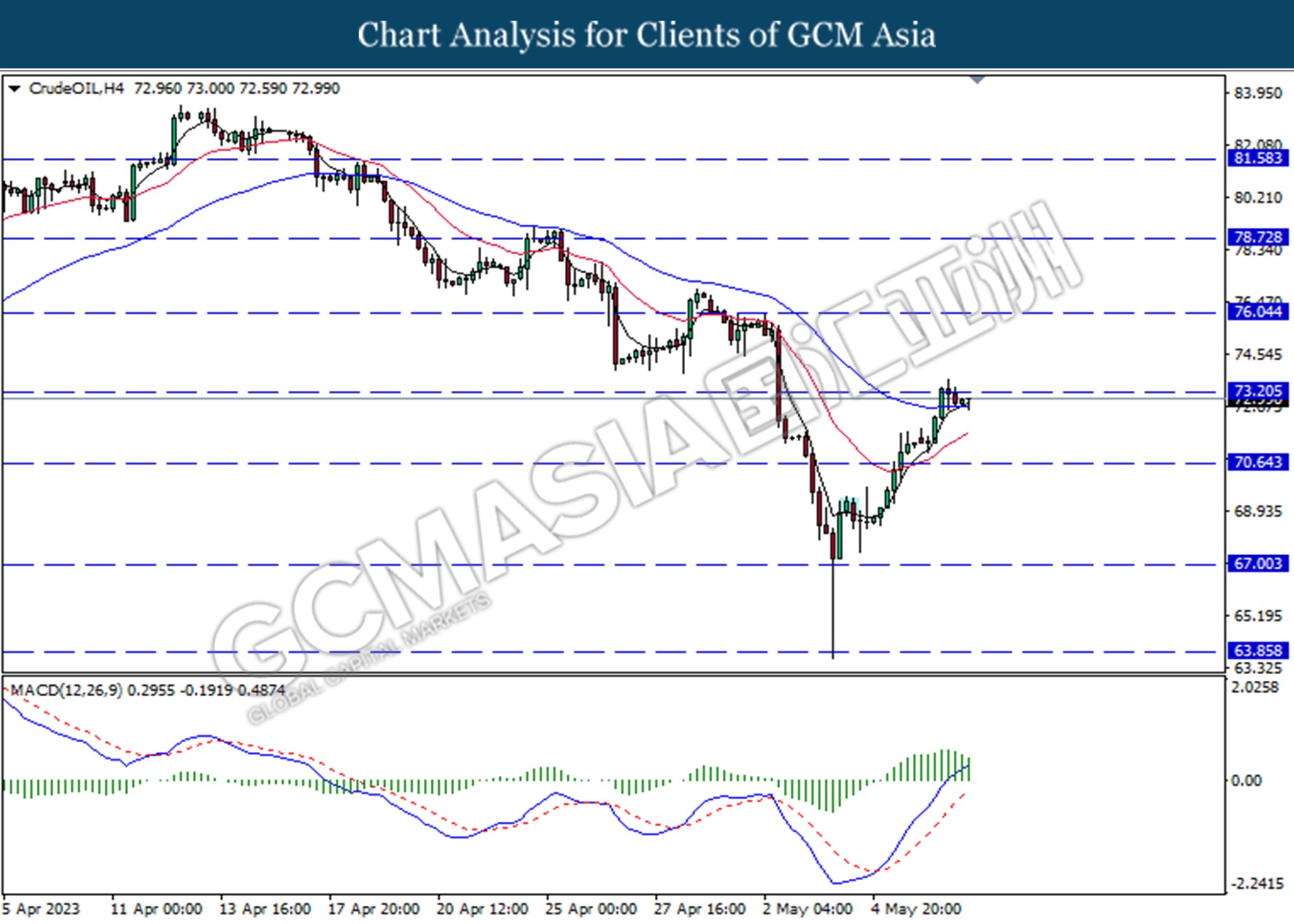

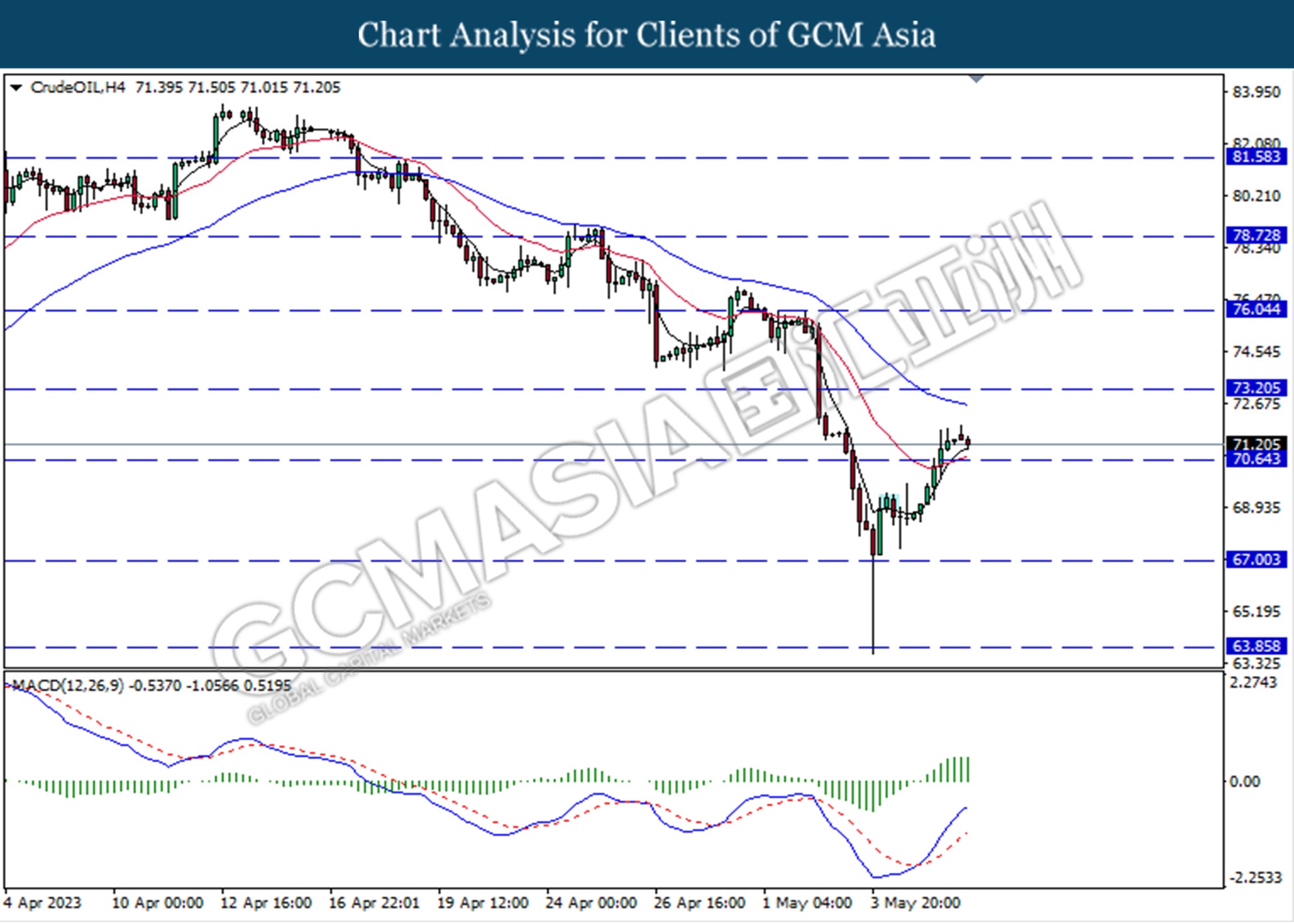

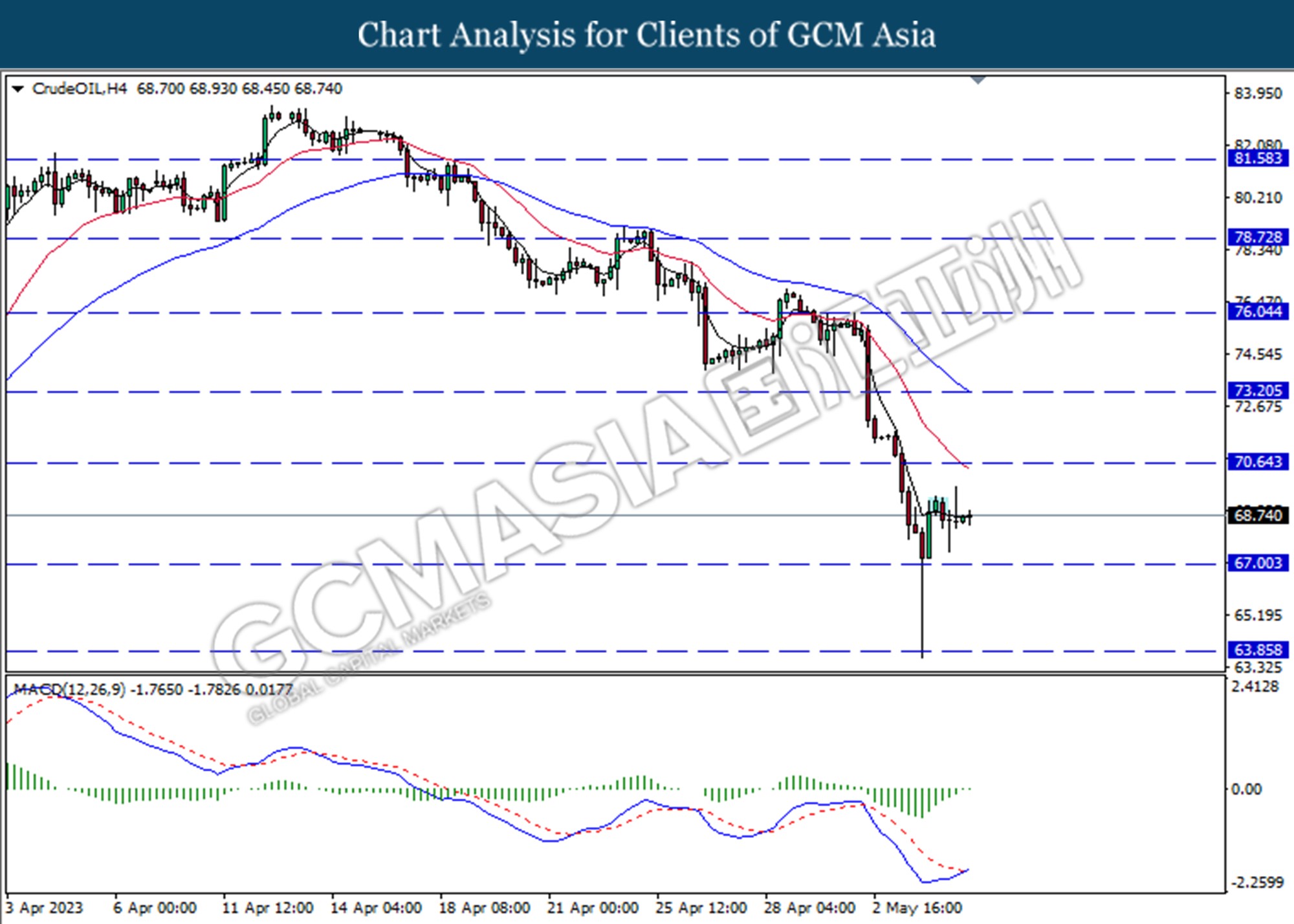

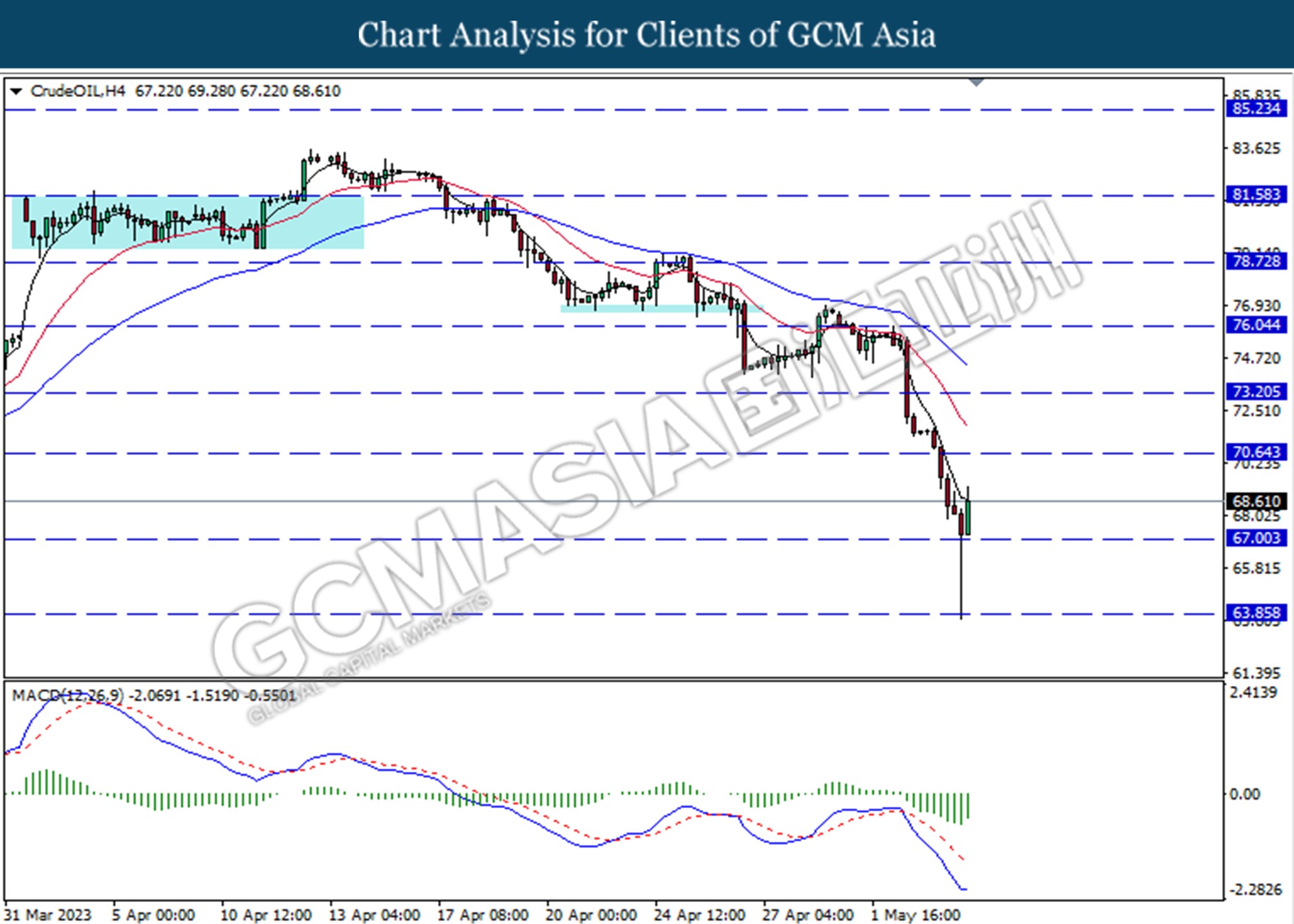

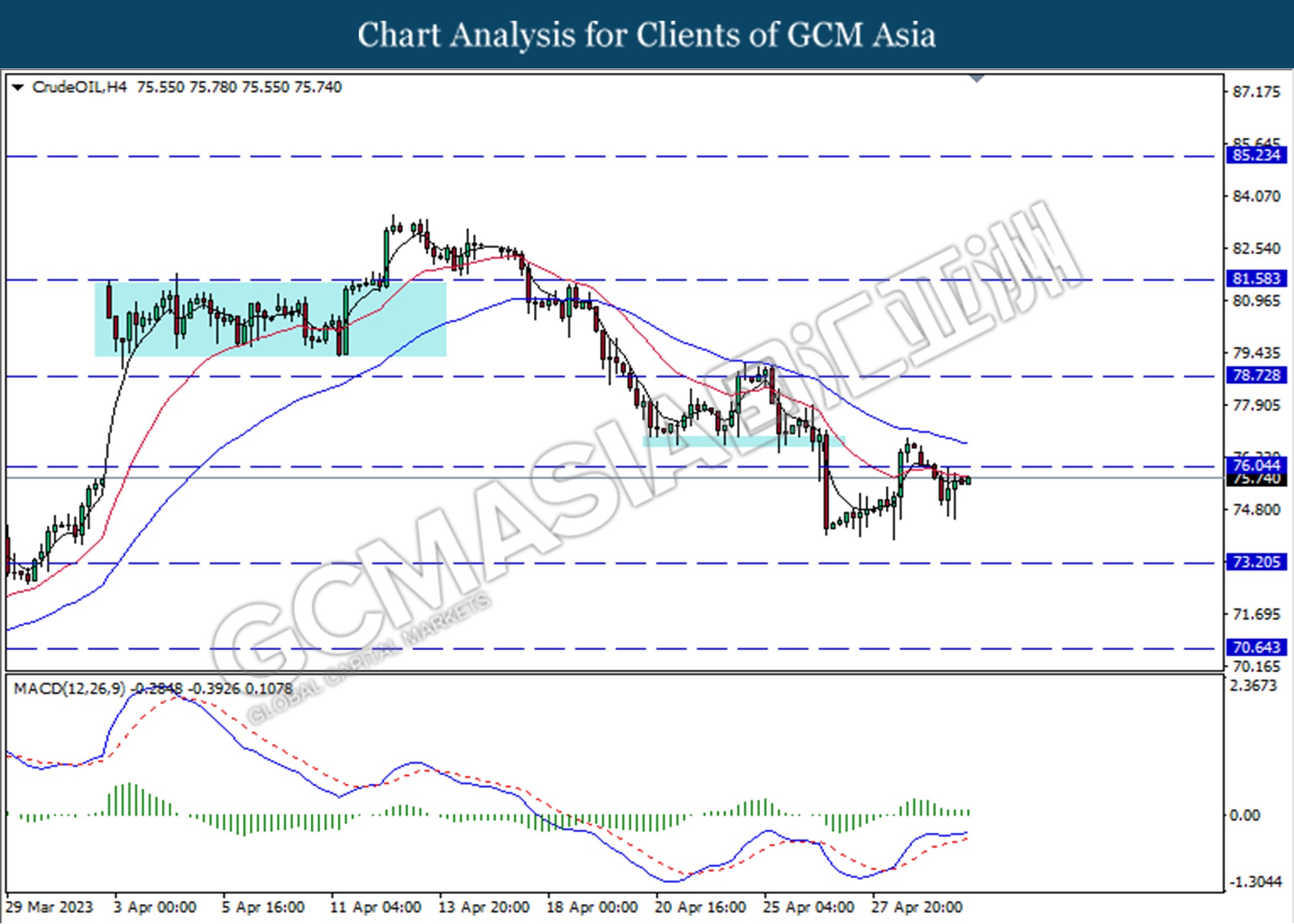

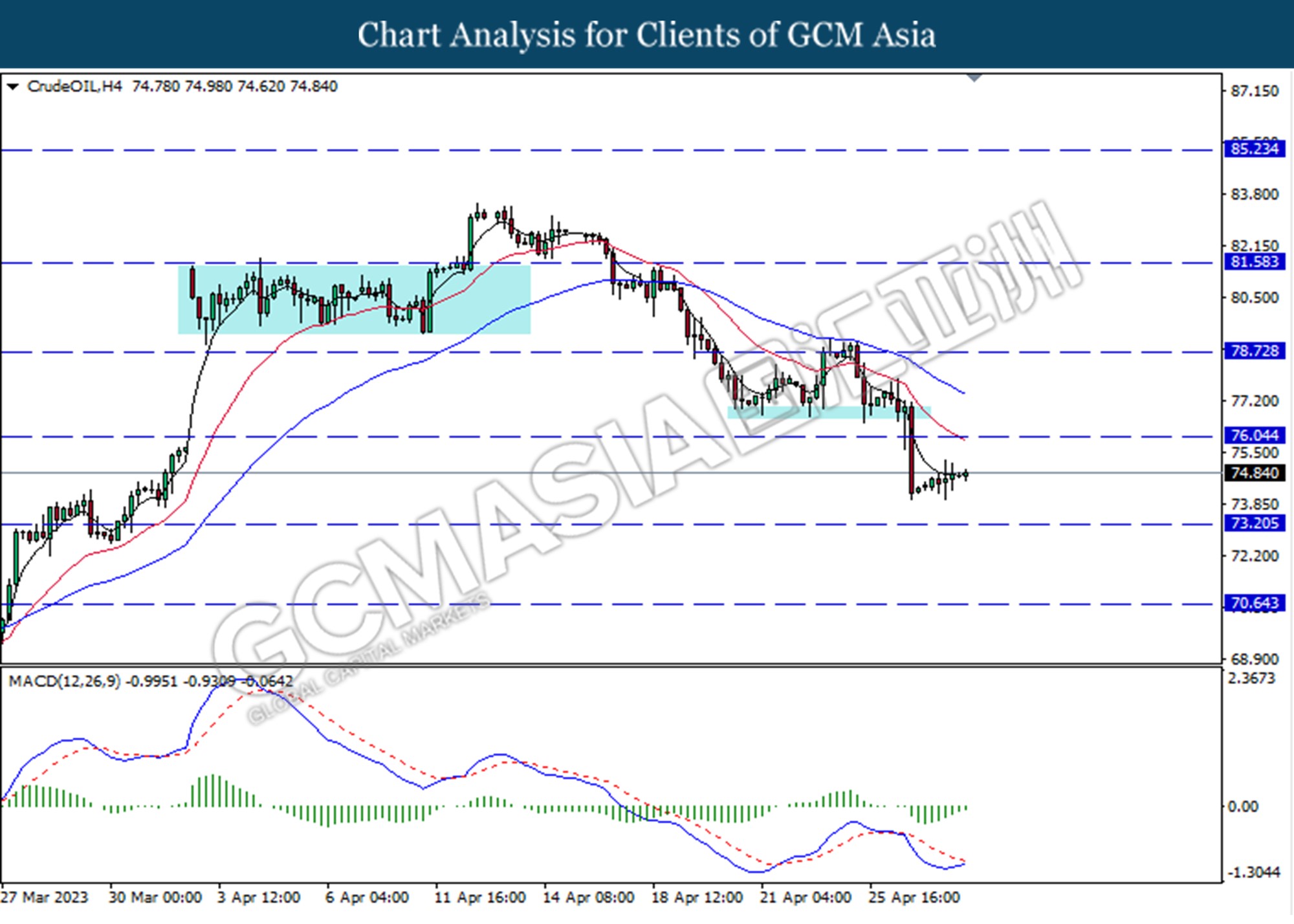

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 73.20. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

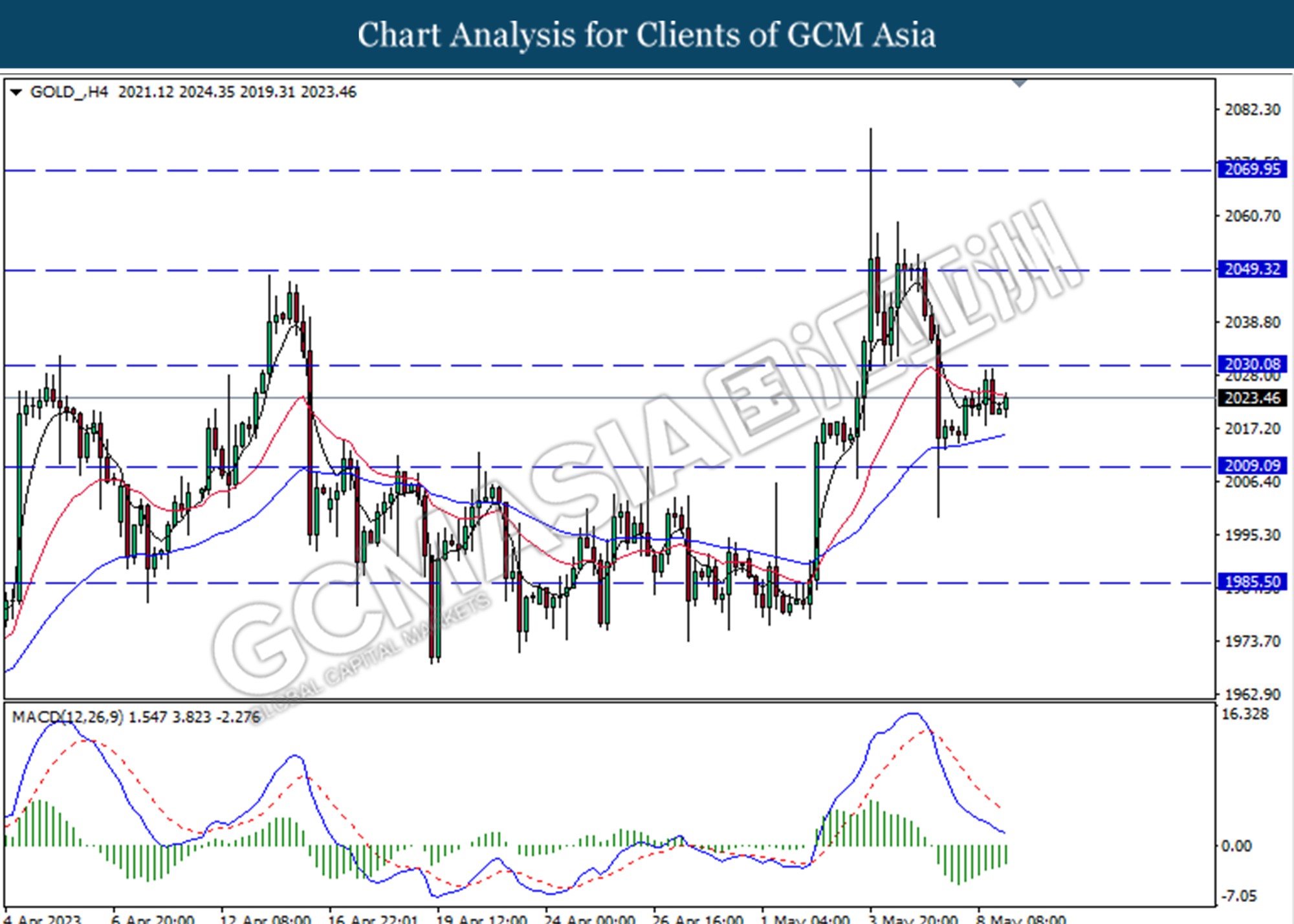

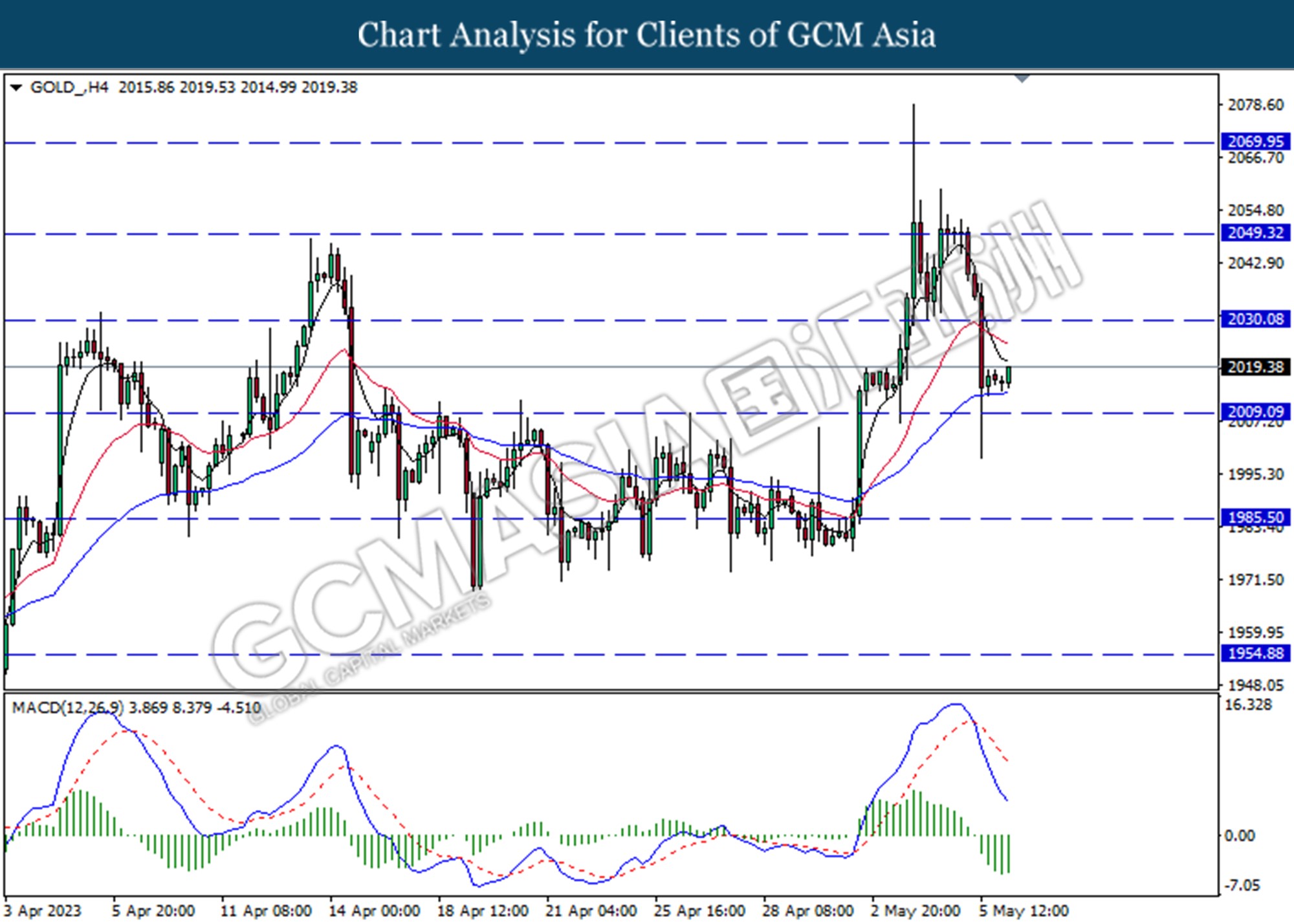

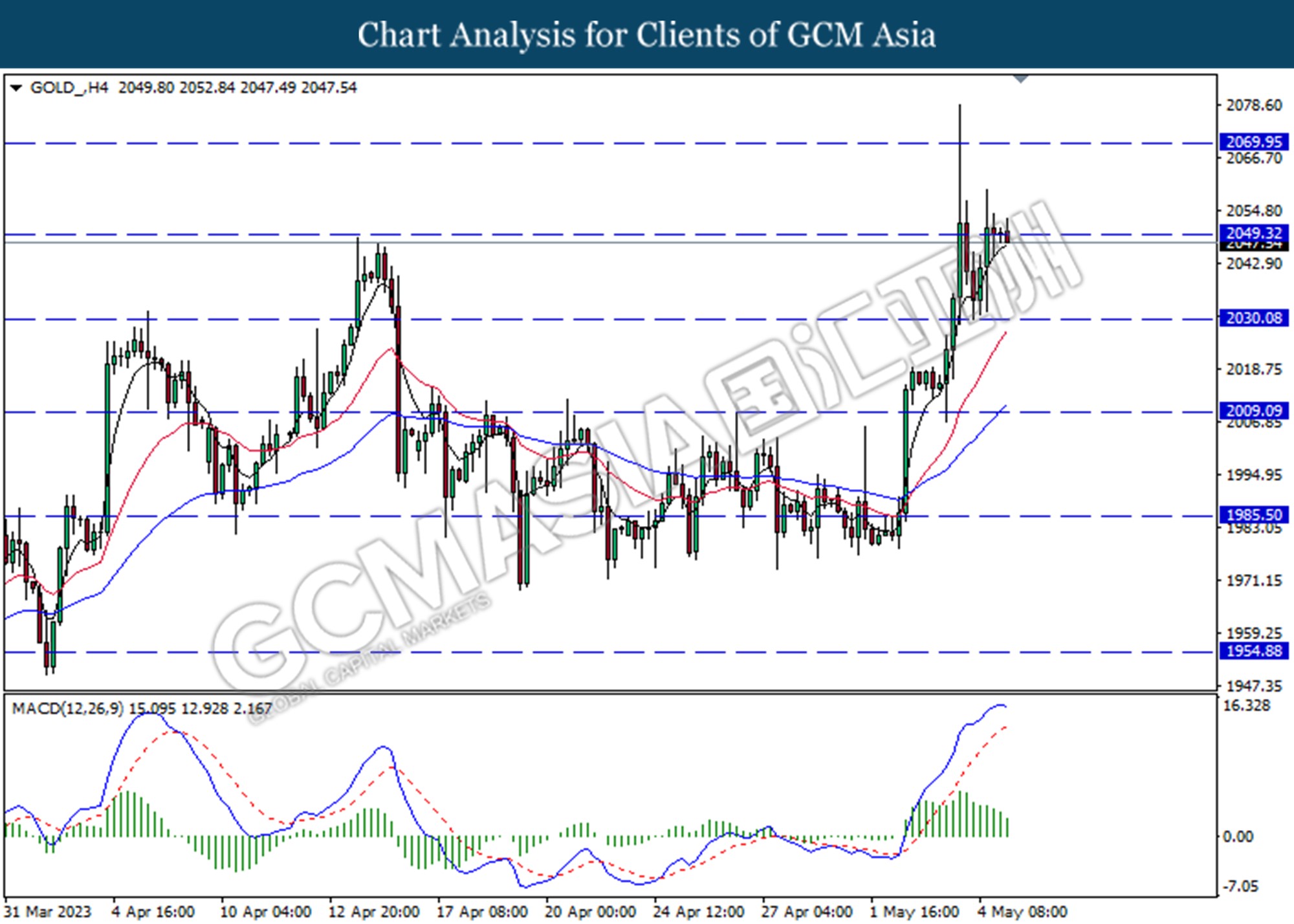

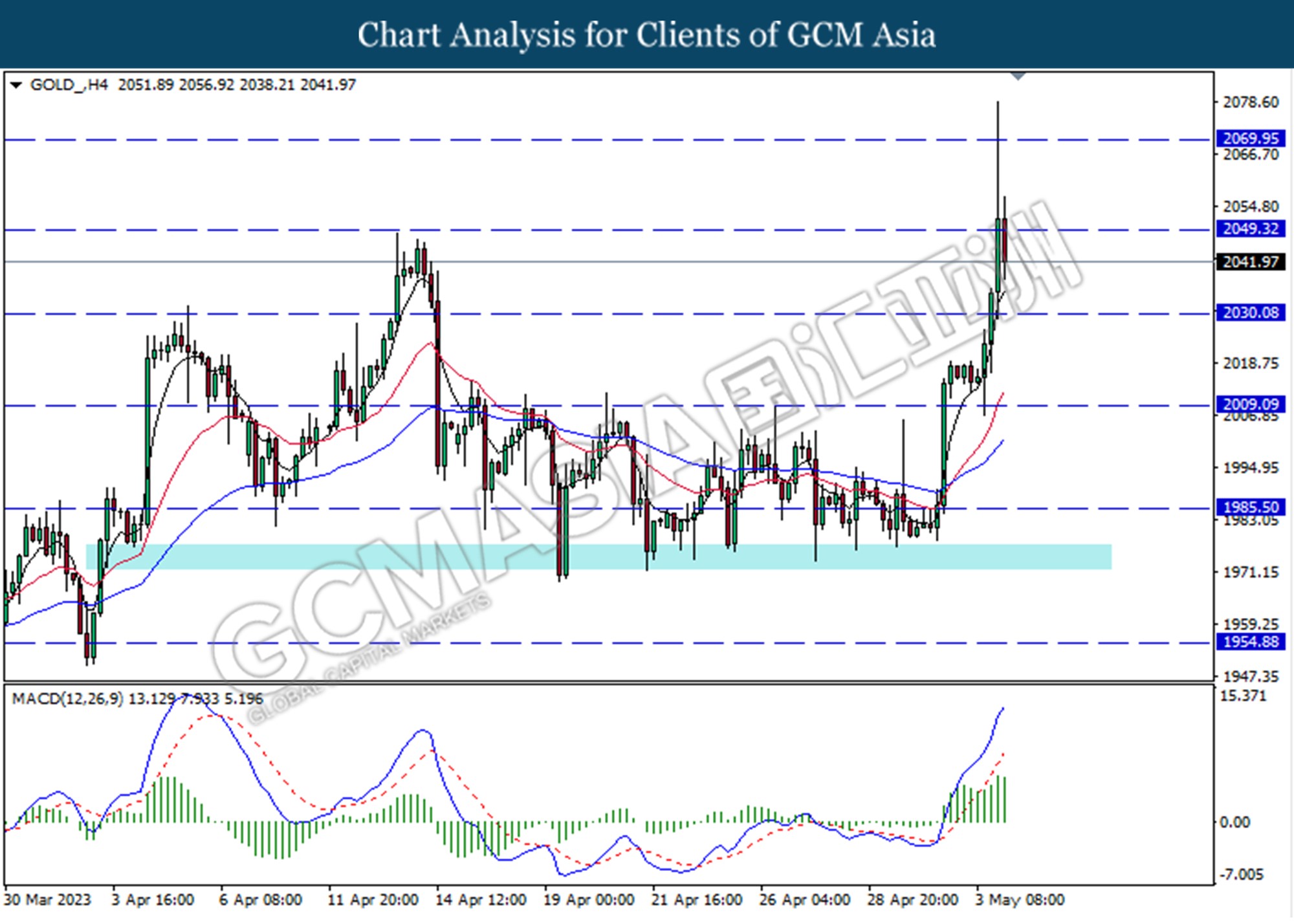

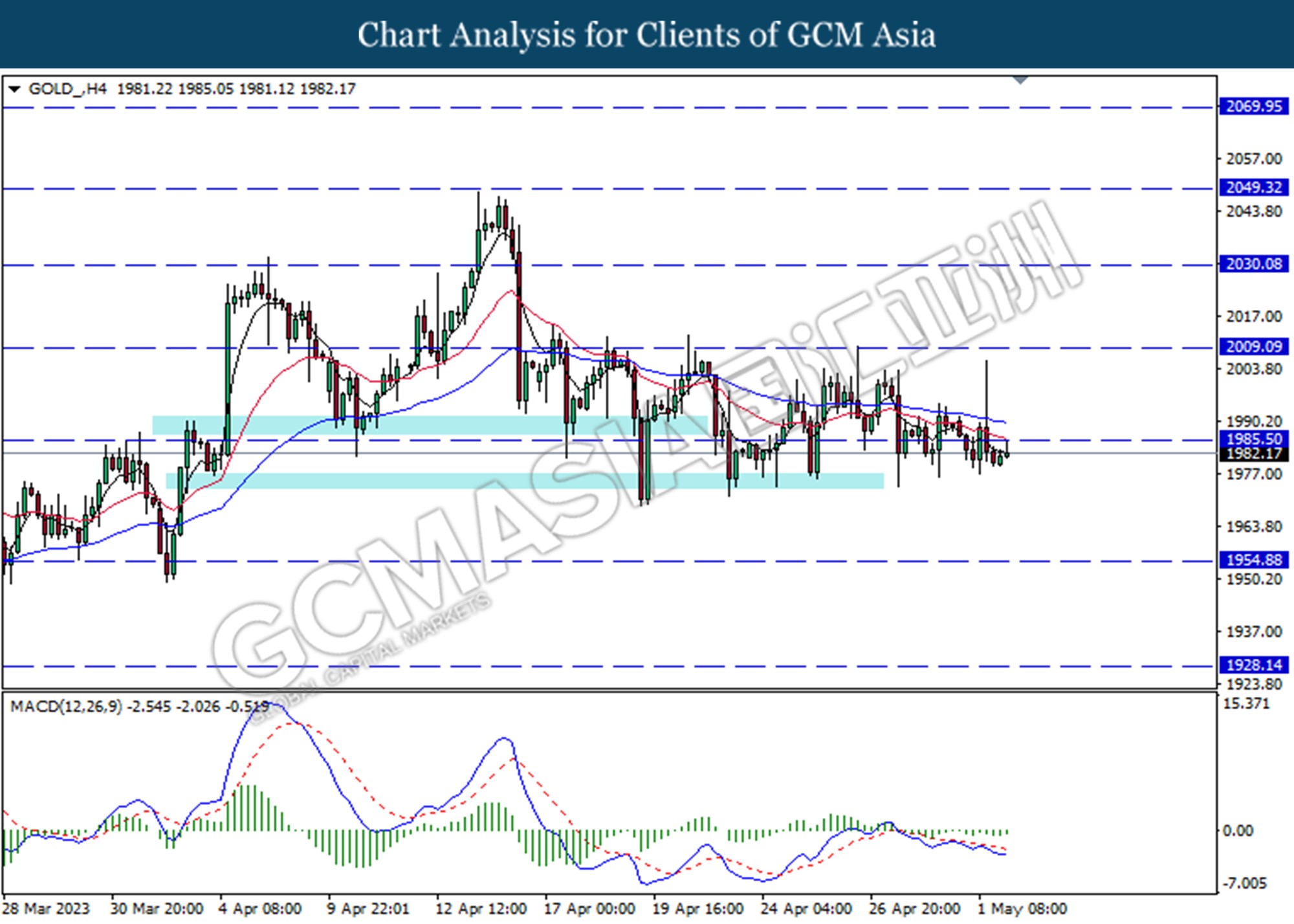

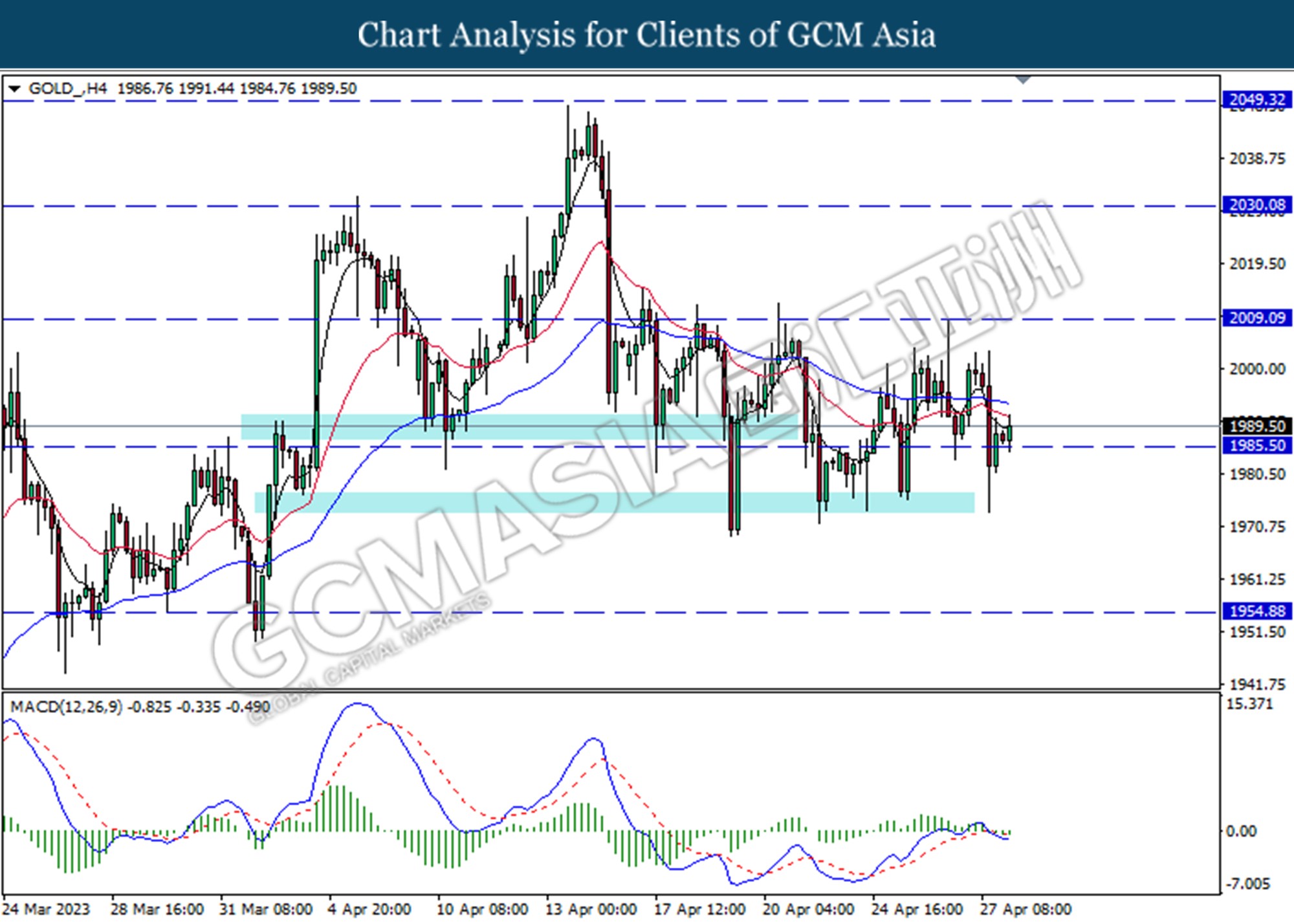

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level at 2030.10

Resistance level: 2030.10, 2049.30

Support level: 2009.10, 1985.50

090523 Morning Session Analysis

9 May 2023 Morning Session Analysis

US Dollar muted as investor awaits for inflation figure.

The dollar index were remained relatively weaker against other major currencies as the investors cautiously await the inflation figure to gauge if the Federal Reserve (Fed) would finally stop their rate hike plan at the level of 5.25%. Last week, the Fed decided to increase its interest rate by another 25 basis point despite the risk of banking crisis. In the Fed’s Press Conference, the remarks that given by the chairman of Fed were ambiguous, where he did not signaled if the Fed would start pausing the rate hike plan in the next meeting. As such, the investors are paying their attention on the long-awaited CPI data as a weaker-than-expected reading would support the case for the Fed to maintain its interest rate at the current level, but a stronger-than-expected result would bolster expectations that the Fed would keep the interest rate at high level for an extended period of time. On top of that, the investors are also eyeing the talk between President Joe Biden and Congressional members. According to Reuters, the US President Joe Biden, top Republicans and Democrats will finally meet up later today, aiming to resolve the head-butting situation between two parties over the $31.4 trillion U.S. debt ceiling and avoid a crippling default by the end of May. As of writing, the dollar index edged up by 0.17% to 101.40.

In the commodities market, crude oil prices edged up by 1.97% to $72.80 per barrel while the investors are waiting for the trade data from largest oil importer, China. Besides, gold prices ticked up by 0.04% to $2022.25 per troy ounce ahead of Wednesday’s inflation data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher while currently retesting the resistance level at 2025.50. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80

080523 Afternoon Session Analysis

8 May 2023 Afternoon Session Analysis

The Loonie extended gains after strong labor market conditions.

The Canadian dollar, commonly known as the Loonie, strengthened against the greenback after delivering upbeat job data last Friday. The Canadian labor market is expected to slow down in April with an estimation of 20k. However, the labor market showed resilience by adding 41.4k jobs, stronger than the prior readings of 34.7k and market estimation. Meanwhile, the unemployment data remains solid as the prior reading at 5.0%, slightly lower than the economist’s expectation of 5.1%. The strong labor data fuels the hope of further interest rate hikes from the Bank of Canada (BoC). Besides, the Loonie regains its luster after the oil price recovers from dips. As the world’s fourth largest crude oil exporter, Canada’s crude oil exports account for 6% of the world’s crude oil exports, and the rise in oil prices will lead to a rise in the Canadian dollar. Economists expect the Canadian dollar will strengthen before the end of the year as a recovery in the global stock index and rising oil prices. Apart from this, the US dollar weakened after the US finance minister reiterate the debt ceiling issue that occurred in the US. The Loonie as the counterpart currency extended its gains following the news. U.S. Treasury Secretary Janet Yellen had warned if Congress fails to address the debt ceiling, the US could face a potential constitutional crisis with major consequences to financial markets and interest rates. For the event, President Joe Biden will meet with Republican and Democratic leaders on 9th May to discuss on the debt ceiling before the June 1st deadline. As of writing, the pair of USD/CAD dipped by -0.03% to $1.3369.

In the commodities market, crude oil prices were up by 0.70% to $71.84 per barrel as investors eye on China trade data to get more cues. Besides, gold prices edged up by 0.26% to $2022.87 per troy ounce fallen after upbeat U.S. labor data. Gold fell as risk appetite improved as non-farm payrolls data showed strong employment conditions.

Today’s Holiday Market Close

Time Market Event

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior break below the previous support level at 101.00. However, MACD which illustrated diminishing bearish momentum suggests the index to traded higher as a technical correction.

Resistance level: 101.00, 101.90

Support level: 100.50, 99.85

GBPUSD, H4: GBPUSD was traded higher following a prior break above the previous resistance level at 1.2590. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 1.2735, 1.2880

Support level: 1.2590, 1.2445

EURUSD, H4: EURUSD was traded higher following the prior rebound from upward trend line. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6685. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6265. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3420. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower following the prior retracement from the resistance level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.8855.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the commodity to traded higher as a technical correction in the short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 2009.10. However, MACD which illustrated bearish momentum suggests the commodity to trade lower as a technical correction.

Resistance level: 2030.10, 2049.32

Support level: 2009.10, 1985.50

080523 Morning Session Analysis

8 May 2023 Morning Session Analysis

Greenback dipped despite upbeat Nonfarm Payroll.

The dollar index, which was traded against a basket of six major currencies, lingered near the lowest level in one month as the investors worried about the renewed banking turmoil as well as the unsolved debt ceiling issue. At this point in time, the PacWest Bancorp are still in the midst of exploring strategic options, which includes fund raising and potential sale. On the other side, the market participants are eyeing on the latest development of US debt ceiling’s negotiation. According to the latest news, Mr. Biden will host House Speaker Kevin McCarthy and other congressional leaders at the White House on Tuesday, his first direct contact in months as officials grapple with the possibility of a first U.S. default as early as June 1. Prior to that, the upbeat employment data surprised the investors, prompted the investors to rush into the dollar market. According to the Bureau of Labor Statistics, the US Nonfarm Payrolls rose from 165K to 253K this month, beating the consensus forecast at 180K. Besides, the US unemployment rate dropped from 3.5% to 3.4%. With that, it indicated that the US labor market surprisingly remained resilient despite a series of aggressive rate hike since more than a year ago. As of writing, the dollar index rose 0.10% to 101.00.

In the commodities market, crude oil prices edged up by 0.05% to $71.50 per barrel as a drone attack on the Ilsky oil refinery in southern Russia, has caused a fire. Besides, gold prices ticked down by -0.05% to $2015.85 per troy ounce as the stronger-than-expected employment data diminished the appeal of gold.

Today’s Holiday Market Close

Time Market Event

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.1050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 2000.00.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80

050523 Afternoon Session Analysis

5 May 2023 Afternoon Session Analysis

The Aussie rose after a series of optimistic economic data releases.

The Australian dollar, commonly known as the Aussie was edged up during Asian trading hours after a series of optimistic economic data was released. The Aussie climbs above the 0.6700 level amid a hawkish monetary policy statement by the Reserve Bank of Australia (RBA). The statements claim that more tightening moves will announce if the inflation remains persistent at a higher space. Prior to that, the recent inflation data in March showed a decline to 7% but remained well above the long-run average 2% target. Since the inflation showed some sign of easing, the market highly anticipated that the RBA would remain at a cash rate of 3.60%. However, the RBA Governor Philip Lower decided to raise the cash rate by another 25 bps to curb high inflation and the moves surprised the market. Besides, the Australian trade balance showed an increase to 15.269B from 14.151B, above the market consensus of 12.650 B. The trade balance hit its highest record since June 2022 as Reuters reported that China sucked in more iron from Australia and boosted the Australian export by 4% in March. In addition, first-home buyer loans unexpectedly rose to 6.5%, stronger than the market consensus forecast and prior reading, with -1.0% and 1.2% respectively. The reading shows that the market’s spending power is on the stronger side, as it increases the likelihood of future rate hikes by the RBA. As of writing, the pair of AUD/USD edged up by 0.64% to $0.6736.

In the commodities market, crude oil prices were up by 0.80% to $ 69.11 per barrel as investors eye on the non-Farm payroll report tonight. Additionally, gold was traded higher after the US dollar weakened earlier on banking concerns. However, the price of gold was still down -0.12% at $2047.53 per troy ounce as of writing.

Today’s Holiday Market Close

Time Market Event

All Day JPY Children’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 50.7 | 51.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 236K | 180K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Apr) | 34.7K | 20.0K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 101.00. However, MACD which illustrated diminishing bearish momentum suggests the index to trade higher as a technical correction.

Resistance level: 101.90, 101.00

Support level: 100.50, 99.85

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2590. However, MACD which illustrated diminishing bullish momentum suggests the index traded lower as a technical correction.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded lower following the prior retracement from the resistance level at 1.1070. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following the prior breakout below the previous support level at 134.55. However, MACD which illustrated diminishing bearish momentum suggests the pair to traded higher as a technical correction.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior break above the previous resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following a prior break above the previous resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6325.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.8855. MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.8855, 0.8925

Support level: 0.8775, 0.8700

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

GOLD_, H4: Gold price was traded lower following a previous break below the previous support level at 2049.30. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10

050523 Morning Session Analysis

5 May 2023 Morning Session Analysis

US dollar steadied against the backdrop of other currencies’ weakness.

The dollar index, which was traded against a basket of six major currencies, managed to hold its ground following a tremendous sell-off in the previous trading session amid the renewed worries over the US banking sector. Early yesterday, PacWest Bancorp experienced a huge drop following the news that the bank was exploring strategic options, including a potential sale. With such a backdrop, it had wiped off the appeal of US dollar and putting the currency on the edge of cliff. Despite, the US dollar still recorded some gains in the last trading session as the European Central Bank (ECB) raised interest rates by 25 basis points to 3.25% in May’s meeting, in line with market expectations, and signaled more rate hikes in the future in order to combat the stubbornly high inflation. It is noteworthy to highlight that the ECB adjusted its interest rate upward by an unprecedented series of 75 and 50 basis point increases in the prior meetings. With this month’s smaller rate hike, it disappointed the investors and hence exerted huge selling pressures in the Euro market. At this point in time, the attention of the investors are all over the upcoming labor data, which is the NonFarm Payroll, as it could provide further hint if Fed would have sufficient space for another rate hike. As of writing, the dollar index rose 0.10% to 101.45.

In the commodities market, crude oil prices edged up by 0.98% to $68.75 per barrel amid the heightening of geopolitical tension is expected to disrupt the oil supply chain. Besides, gold prices ticked down by 0.04% to $2049.50 per troy ounce as dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day JPY Children’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 50.7 | 51.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 236K | 180K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Apr) | 34.7K | 20.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.1050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3565. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8780.

Resistance level: 0.8865, 0.9000

Support level: 0.8780, 0.8670

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2069.55. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2069.55, 2100.00

Support level: 2025.50, 1972.80

040523 Afternoon Session Analysis

4 May 2023 Afternoon Session Analysis

Euro edged up ahead of ECB’s interest rate decision.

The euro dollar, one of the most traded currencies by global investors, edged up ahead of European Central Bank (ECB) interest rate decision. The ECB had lifted the interest by a 350 basic point since July to fight against stubborn inflations. Recent data on Tuesday also showed eurozone Consumer Price Index (CPI) held at a high of 7.0%, in line with market expectations, but slightly higher than previously. However, the core CPI without the energy and food readings slightly reduced to 5.6% from 5.7%. The current CPI reading is still far from ECB’s 2% targets, and investors expect ECB will be more further tightening its next monetary policy. Besides, a survey of the first quarter Bank Lending Survey (BLS) by the ECB, unveils the ECB’s intention to further tightening on bank leading standards. The main driver of the tightening is increased risk perception and, to a lesser extent, lower risk tolerance for banks. Since the ECB had a tightening impact on credit standards for loans in Euro areas. The money liquidity supply will decrease and further cool the high inflation in the eurozone. Meanwhile, investors’ eyes on the upcoming monetary policy by ECB’s monetary policy decision. Markets are pricing in a 25-basis point rate hike after three consecutive 50 basis point hikes. As of writing, the pair of EUR/USD edged up by 0.24% to $1.1086.

In the commodities market, crude oil prices were traded up by 0.67% to $69.05 per barrel after investors were concerned about supply disruption in Russia and Iran. Besides, gold prices were down by -0.06% to $2037.53 per troy ounce amid Fed signals for a potential pause on hiking interest rates.

Today’s Holiday Market Close

Time Market Event

All Day JPY Greenery Day

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Apr) | 52.2 | 53.9 | – |

| 16:30 | GBP – Services PMI (Apr) | 52.9 | 54.9 | – |

| 20:15 | EUR – Deposit Facility Rate (May) | 3.00% | 3.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 3.75% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (May) | 3.50% | 3.75% | – |

| 20:30 | USD – Initial Jobless Claims | 230K | 240K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 58.2 | 59.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior break below the previous support level at 101.00. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level.

Resistance level: 101.00. 101.90

Support level: 100.50, 99.85

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2590. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded higher following a prior break above the previous resistance level at 1.1070. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1225, 1.1375

Support level: 1.1070, 1.0930

USDJPY, H4: USDJPY was traded lower following the prior break below the previous support level at 134.55. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following a prior break below the previous support level at 0.8855. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8855, 0.8925

Support level: 0.8775, 0.8700

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 67.00. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

GOLD_, H4: Gold price was traded lower following the prior break below the previous resistance level at 2049.30. However, MACD which illustrated bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10

040523 Morning Session Analysis

4 May 2023 Morning Session Analysis

Greenback wobbled following an expected rate hike by Fed.

The dollar index, which was traded against a basket of six major currencies, teetered near the brink of collapse despite the Federal Reserve decided to increase its cash rate by another 25 basis point in the early morning meeting. As widely expected, the FOMC raised its interest rate to 5.25%. However, with the backdrop of heightening risk of crisis and sign of growth slowing down, the attention of the market was more on the future path of the monetary policy. Fed Chairman Jerome Powell said at Wednesday’s press conference that no decision was made today to pause the interest rate, but they open door to rate hike pause. While comparing to the last meeting’s statement, the Fed skipped a line that had appeared in the previous statement that “the committee anticipates that some additional policy tightening may be appropriate” to achieve the Fed’s 2% inflation target. Such a tentative hint might indicate that the current tightening cycle is at an end, dragging down the appeal of US dollar. Besides, the losses of the currency extended after a report said the PacWest Bancorp was weighing strategic options, including a possible sale. It shows that the persistent Fed’s rate hike and the prior fallout in US banks are possibly brewing a crisis, where a lot of companies are actually struggling with a risk of financial problem. As of writing, the dollar index dropped -0.72% to 101.20.

In the commodities market, crude oil prices were down by -2.55% to $66.75 per barrel amid the exacerbating of market worries against the future prospect of oil demand. Besides, gold prices ticked up by 0.83% to $2055.40 per troy ounce as PacWest Bancorp is weighing on a potential sale.

Today’s Holiday Market Close

Time Market Event

All Day JPY Greenery Day

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Apr) | 52.2 | 53.9 | – |

| 16:30 | GBP – Services PMI (Apr) | 52.9 | 54.9 | – |

| 20:15 | EUR – Deposit Facility Rate (May) | 3.00% | 3.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 3.75% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (May) | 3.50% | 3.75% | – |

| 20:30 | USD – Initial Jobless Claims | 230K | 240K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 58.2 | 59.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8855. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2069.55. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2069.55, 2100.00

Support level: 2025.50, 1972.80

030523 Afternoon Session Analysis

3 May 2023 Afternoon Session Analysis

The Kiwi jumped after upbeat economic data was released.

The New Zealand dollar, commonly knowns as the Kiwi, jumped to the highest level in three weeks’ time at 0.6230. The reason the Kiwi pair soared up as the investors were cheering for an upbeat quarterly employment data. Statistics New Zealand unveiled the first quarter 2023 employment report early today, where it showed that the quarterly employment change increased to 0.8%, beating the market expectations and previous readings at 0.4% and 0.2% respectively. The rise in employment changes could have positive implications for consumer spending and stimulate economic growth. Besides, the unemployment data’s reading stood at 3.4%, similar to the prior reading, beating the market expectation for an increase of 3.5%. A series of upbeat labor data gives the RBNZ more room to further tightening in the future. On the other hand, Reserve Bank of New Zealand (RBNZ) Deputy Governor Christian Hawkesby said the housing prices had continued to decline and close to the sustainable level, while the ongoing labor market showed resilient conditions. The central bank is currently looking at easing loan-to-value ratio restrictions for home buyers. Ongoing strength in the labor market enables borrowers to adjust their spending and repayment of their debts. As a result, the pair of NZD/USD appreciated 0.465 to $0.6236.

In the commodity market, crude oil prices fell -0.07% to $71.64 a barrel after the market worried that the US debt ceiling would further affect crude oil demand. Besides, gold prices edged up by 0.11% to $2018.86 per troy ounce as US anxiety boosted the demand for safe-haven assets.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

All Day JPY Constitution Day

Today’s Highlight Events

Time Market Event

Tentative GBP BoE Quarterly Bulletin

02:30 USD FOMC Press Conference

(3rd May)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – Unemployment Rate (Mar) | 6.6% | 6.6% | – |

| 20:15 | USD – ADP Nonfarm Employment Change

(Apr) |

145K | 150K | – |

| 21:45 | USD – S&P Global Composite PMI (Apr) | 52.3 | 53.5 | – |

| 21:45 | USD – Services PMI (Apr) | 52.6 | 53.7 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Apr) | 51.2 | 51.8 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -5.054M | -1.486M | – |

| 02:00 | USD – Fed Interest Rate Decision | 5.00% | 5.25% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the resistance level at 101.90. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level at 101.00.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded lower following the prior rebound from the support level at 1.2445. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded following the prior rebound from the support level at 1.0930. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following a previous break below the support level at 136.30. MACD which illustrated increasing bearish momentum suggests the pair extended its losses towards the support level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded higher following a prior break below from the previous support level at 0.6685. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6195. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3600.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8925. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.8855.

Resistance level: 0.9005, 0.9090

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded lower following the prior breaks below the previous support level at 73.20. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 66.05

GOLD_, H4: Gold price was traded higher following the prior breaks above from the previous resistance level at 2009.10. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes technical correction in the short term.

Resistance level: 2030.10, 2049.30

Support level: 1985.50, 1954.90

030523 Morning Session Analysis

3 May 2023 Morning Session Analysis

US dollar slumped amid disappointing job data.

The dollar index, which was traded against a basket of six major currencies, received some bearish pressures after hitting the 3-week high as the US job data fell more than expected in March. According to the Bureau of Labor Statistics, the US JOLTs Job Openings dropped from 9.974M to 9.590M, significantly lower than the consensus forecast at 9.775M. The huge drop of job vacancies refreshed the record of the lowest level in nearly 2 years while mirroring a sign that the ultra-tight US labor market was easing. The lower-than-expected result also suggests that wage pressures have eased, thereby easing inflation and reducing pressure on the Fed to raise interest rates further in the future. Besides, the heightening of US default risk also disrupted the financial market yesterday. Treasury Secretary Janet Yellen notified US Congress that the US could default on its debt once it ran out of measures to repay its debt on the 1st of June 2023. At this point in time, the impasse of passing the bill to increase the debt ceiling continues amid head-butting between the Republicans and Democrats over the spending cuts issue. Without raising the debt ceiling, it is expected to spark a 2008-style economic catastrophe that would wipe out millions of jobs and sets the US in a recession for an unforeseen period of time. As of writing, the dollar index edged down -0.22% to 101.95.

In the commodities market, crude oil prices were down by -4.55% to $71.55 per barrel, with the backdrop of Iranian oil production surpassing 3 million barrels per day. Besides, gold prices ticked down by -0.03% to $2016.20 per troy ounce after jumping significantly yesterday amid the risk of US default heightened.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

All Day JPY Constitution Day

Today’s Highlight Events

Time Market Event

Tentative GBP BoE Quarterly Bulletin

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – Unemployment Rate (Mar) | 6.6% | 6.6% | – |

| 20:15 | USD – ADP Nonfarm Employment Change

(Apr) |

145K | 150K | – |

| 21:45 | USD – S&P Global Composite PMI (Apr) | 52.3 | 53.5 | – |

| 21:45 | USD – Services PMI (Apr) | 52.6 | 53.7 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Apr) | 51.2 | 51.8 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -5.054M | -1.486M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 101.25. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1010. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.30. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 137.60, 138.95

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8865.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 73.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

020523 Afternoon Session Analysis

2 May 2023 Afternoon Session Analysis

The Aussie soars up after the RBA hikes cash rates.

The Reserve Bank of Australia (RBA) hikes cash rate by 25 basis points to 3.85% from 3.60%, the Aussie soars up afterward. Since the RBA Governor Philip Lowe had maintained the interest rate at 3.60% in April, the markets anticipate that the RBA will likely remain on hold on its following tightening monetary policy. However, the RBA moves to surprise the market. Lowe said that the inflation in Australia has passed its peak, but the inflation remains sticky at 7% and far from the RBA 2% target range. The statement mentioned that inflation needs to take a couple of years to decline and expects to achieve 4.5% and the end of 2023 and 3% in 2025, according to the central bank. This also contributed to the RBA’s decision to maintain its tightening monetary policy. Besides, Australia’s recent labor data confirmed that the labor market remains in tight conditions with the unemployment rate at a bear 50-year low. As wage growth has increased in response to the tight labor market and high inflation. It provides additional space for the RBA to tighten in May. As of writing, the AUD/USD soars up by 1.16% to $0.6706.

In the commodities market, crude oil prices were up by 0.09% to $75.73 per barrel as mixed economic data from China and investors forecasts on declining crude stockpiles. Besides, gold prices edged up by 0.04% to $1983.38 per troy ounce as investors awaited the Fed interest rate hike.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Apr) | 44.0 | 44.0 | – |

| 16:30 | GBP – Manufacturing PMI (Apr) | 47.9 | 46.6 | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 22:00 | USD – JOLTs Job Openings (Mar) | 9.931M | 9.775M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the resistance level at 101.90. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.00.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded higher following rebounded from the lower level at. However, MACD which illustrated bearish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 136.30.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

AUDUSD, H4: AUDUSD was traded higher following rebounded from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following rebounded from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.8925.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 76.05.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1985.50. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains after it successfully breakout above the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15

020523 Morning Session Analysis

2 May 2023 Morning Session Analysis

Greenback revived amid upbeat manufacturing data.

The dollar index, which was traded against a basket of six major currencies, regained its luster after hitting the lowest level in three years as the manufacturing activity in the US slightly improved, but still in the contraction territory with a slower pace. According to the Institute Supply Management (ISM), the US Manufacturing PMI was printed at 47.1 in April, stronger than the consensus forecast and prior month’s reading at 46.8 and 46.3 respectively. In details, there are only 2 of the 6 biggest manufacturing industries experienced a growth in April, which are the petroleum and coal products and transportation equipment. The sluggish activity was caused by the higher borrowing costs and tighter credit, which have raised the market worries over the risk of recession and restricted the customers from placing orders. Besides, the acquisition of First Republic Bank has largely reduced the market fears about further banking crisis to happen in the nation, lifting the appeal of the US dollar. Yesterday, JP Morgan won the auction to buy seized First Republic Bank for$12 billion. JP Morgan will be on the hook for all of the First Republic Bank’s $92 billion in deposits, including the $30 billion that JP Morgan and other big banks injected into the bank in March to keep it from going bankrupt. JP Morgan will also acquire most of the assets, including about $173 billion in loans and $30 billion in securities. As of writing, the dollar index rose 0.47% to 102.15.

In the commodities market, crude oil prices were down by -0.10% to $75.80 per barrel as the disappointing China Manufacturing PMI weighed on the prospect of oil demand. Besides, gold prices ticked down by -0.04% to $1982.80 per troy ounce as contagion fears disappeared following the acquisition of First Republic Bank.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (May) | 3.60% | 3.60% | – |

| 15:55 | EUR – German Manufacturing PMI (Apr) | 44.0 | 44.0 | – |

| 16:30 | GBP – Manufacturing PMI (Apr) | 47.9 | 46.6 | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 22:00 | USD – JOLTs Job Openings (Mar) | 9.931M | 9.775M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 101.25. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2645, 2.2765

Support level: 1.2525, 1.2405

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 136.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.95.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3565. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3485.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 77.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 73.90.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1972.80. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

280423 Afternoon Session Analysis

28 April 2023 Afternoon Session Analysis

The yen slipped after the BoJ maintained its policy.

The Japanese Yen the third most commonly traded currency in the world slipped amid the Bank of Japan (BoJ) maintained its ultra-loosen monetary policy. Kazuo Ueda, the new governor of the Bank of Japan, kept interest rates at -0.1%, and the 10-year government bond yield remained near zero, in line with market consensus. As a result, the pair of USDJPY soar up as the Japanese Yen experienced a massive sell-off by global investors. However, the recent optimistic economic data released was unable to save the Yen from falling. The Bureau of Statistics of Japan showed that the Tokyo Consumer Price Index grew to 3.5% from 3.2%, above the market estimation of 3.2%. The board revised its core consumer inflation afterward, to 1.8% from 1.6% under previous projections made in January and 2.0% in the following year. Besides, the retail sales data rose to 7.2%, upbeat the market expectation of 5.8%. The series of optimistic economic data lost its luster after the BoJ monetary easing. As of writing, the pair of USD/JPY soars up 0.82% to $135.03.

In the commodities market, crude oil prices edged up by 0.49% to $75.12 per barrel following a prior sharp decline in price after the recession risk increased. Besides, gold prices dipped down by -0.14% to $1985.09 per troy ounce as strong inflation and labor data in the US

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q1) | 0.9% | 0.3% | – |

| 20:00 | EUR – German CPI (MoM) (Apr) | 0.8% | 0.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Mar) | 0.3% | 0.3% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.5% | 0.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Apr) | 63.5 | 63.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the support level at 101.00. MACD which illustrated increasing bullish momentum suggests the index extended its gains towards the resistance level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6600. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6120. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3600. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.8925. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 76.05.

Resistance level: 76.05, 81.60

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 1985.50. However, MACD which illustrated bearish momentum suggests the commodity to trade lower as a technical correction.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

280423 Morning Session Analysis

28 April 2023 Morning Session Analysis

Greenback wobbled amid mixed economic data.

The dollar index, which was traded against a basket of six major currencies, experienced a relatively mixed trading session yesterday as the economic data delivered unclear signs to the investor. According to the Bureau of Economic Analysis, the US Gross Domestic Product (GDP) posted a reading at 1.1% to round up the first quarter of 2023, far weaker than the consensus forecast at 2.0%. The downbeat data showed that the growth of economy started to decelerate during the first 3 months of the year, which largely attributed to the impact of rising interest rate as well as solid inflation in the nation. However, the unexpected drop in the number of Americans filed for unemployment claims managed to hold the dollar index from falling sharply. Based on the data from Department of Labor, US Initial Jobless Claims dropped from 246K to 230K this week, lower than the consensus forecast at 248K, mirroring a still-tight labor market in the US. Nonetheless, the mixed economic data did not deter the market expectation of a further rate hike in the May meeting. As of writing, the dollar index edged up 0.02% to 101.50.

In the commodities market, crude oil prices were up by 0.23% to $74.50 per barrel as the black commodity price stabilized after dropping sharply during the prior trading session. Besides, gold prices ticked down by -0.04% to $1987.10 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

13:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Apr) | 16K | 10K | – |

| 16:00 | EUR – German GDP (QoQ) (Q1) | 0.9% | 0.3% | – |

| 20:00 | EUR – German CPI (MoM) (Apr) | 0.8% | 0.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Mar) | 0.3% | 0.3% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.5% | 0.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Apr) | 63.5 | 63.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.