12 July 2022 Afternoon Session Analysis

Euro dived, approaching toward parity with dollar.

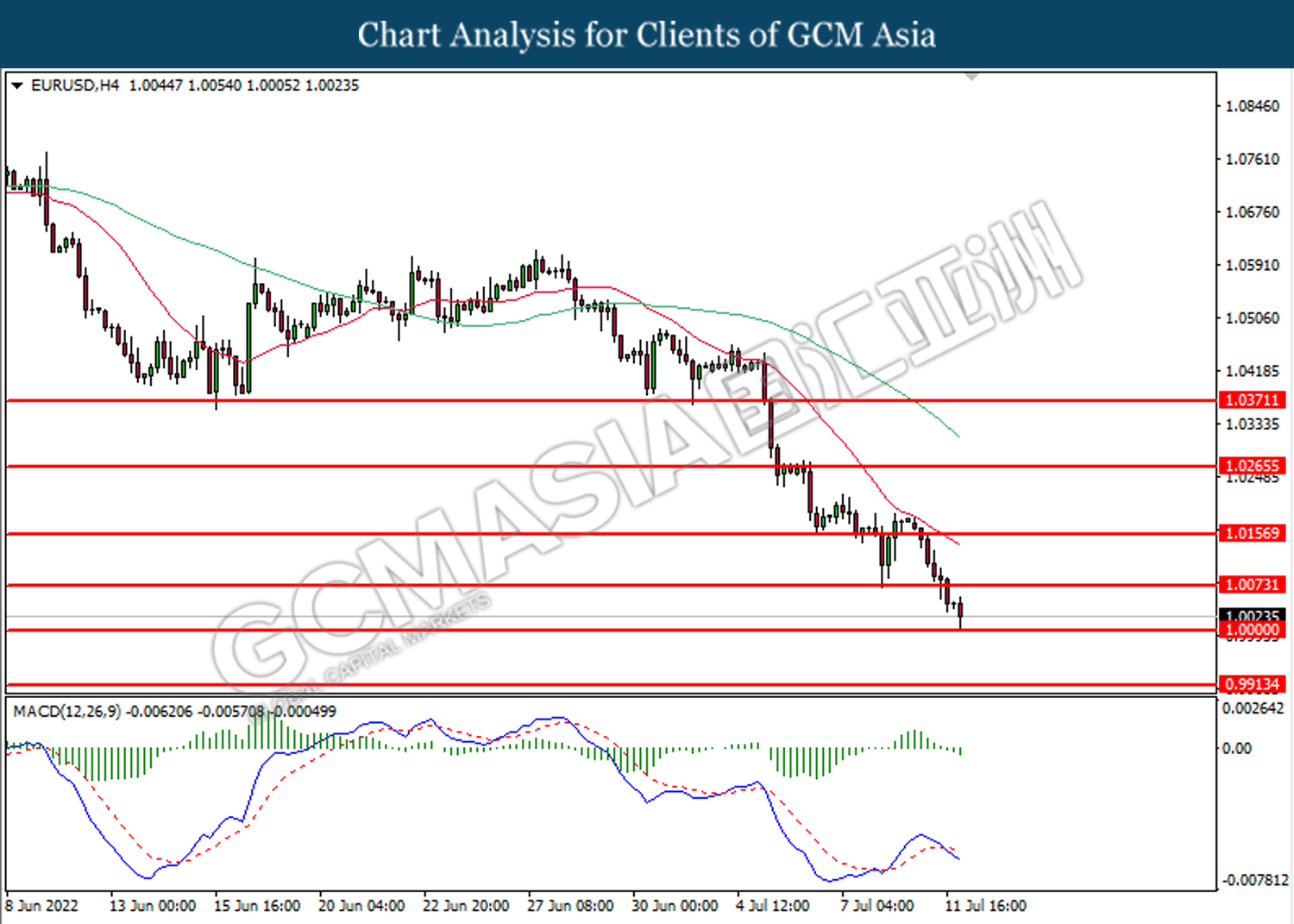

The Euro, which is traded by the majority of investors across the globe, slumped significantly this morning as investors put a bet on the Euro dollar parity for the first time in 20 years. In fact, the single currency – The euro has been receiving tremendous bearish momentum since the initiation of the Russo-Ukrainian war. Despite Europe did not have the immediacy of involvement in the war, the sanctions initiated by the Eurozone have put themselves on the edge of the hill, where an energy crisis tipped the region into a recession. Back to a few months ago, Russia cut 60% of the natural gas flow to Germany through Nord Stream 1. While the tensions between Ukraine and Russia heightened, the concerns that an energy crisis would happen in the region increased as well. On the other side, the pair of EUR/USD slumped further as the US currency was boosted by the expectations that the Federal Reserve will hike rates faster and further than peers. As of writing, the pair of EUR/USD is down 0.14% to 1.0025.

In the commodities market, the crude oil price was down by 0.56% to $100.30 as the rising of Covid-19 cases in China is expected to derail the recovery path of the nation. Besides, the gold prices dived 0.03% to $1734.40 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

|

Time |

Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Jul) | -28.0 |

-38.3 |

– |

Technical Analysis

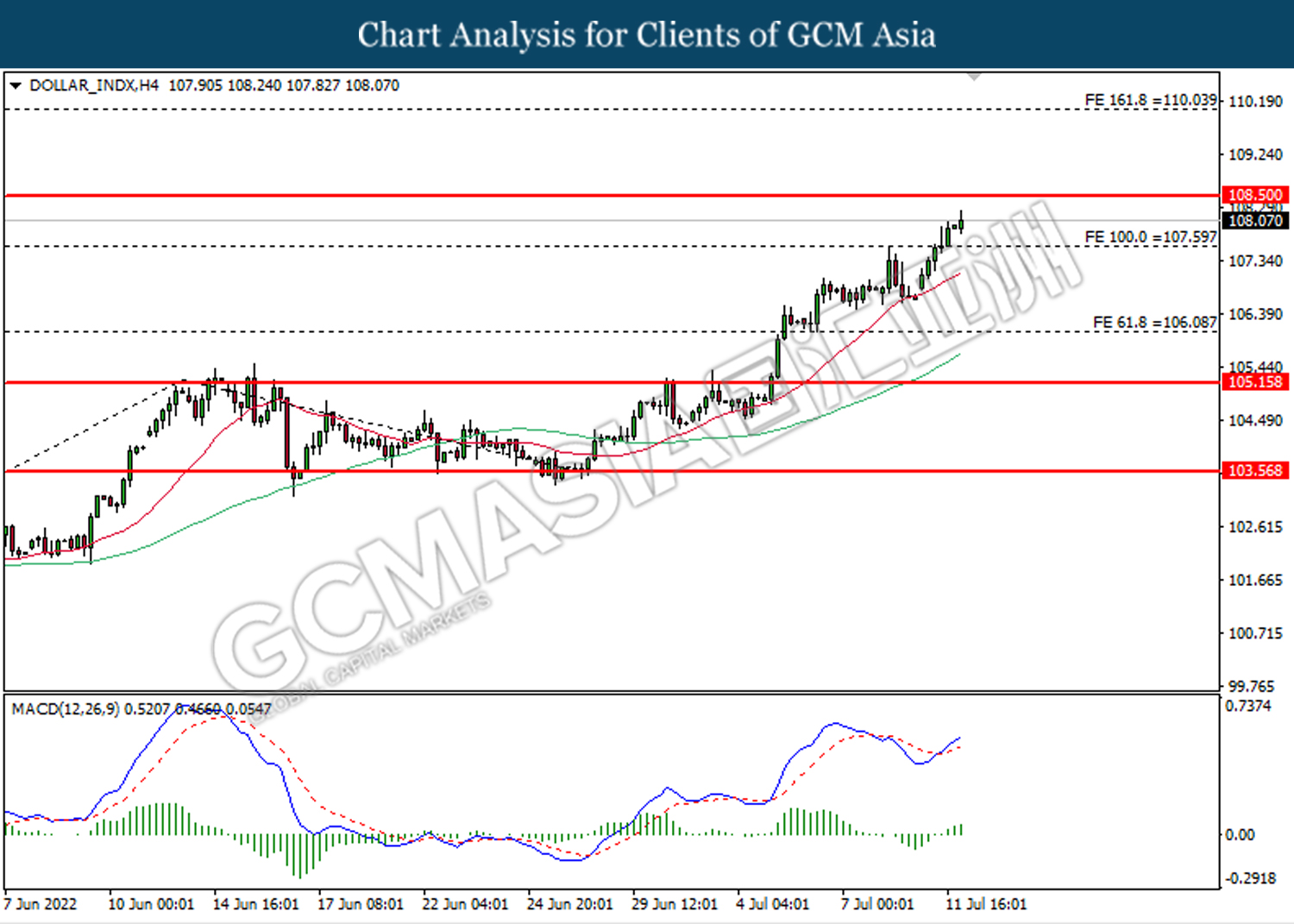

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 107.60. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 108.50.

Resistance level: 108.50, 110.05

Support level: 107.60, 106.10

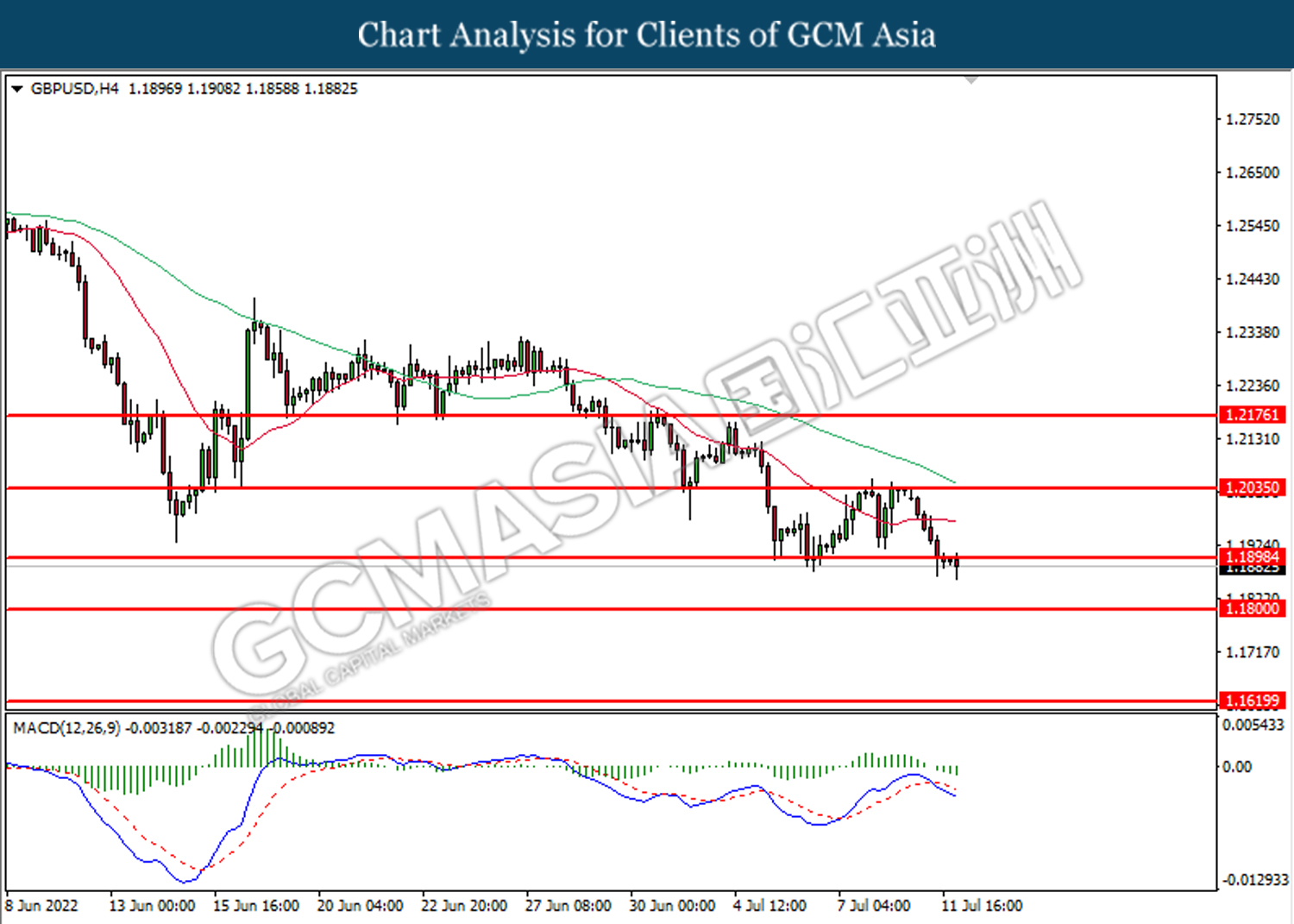

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.1900. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

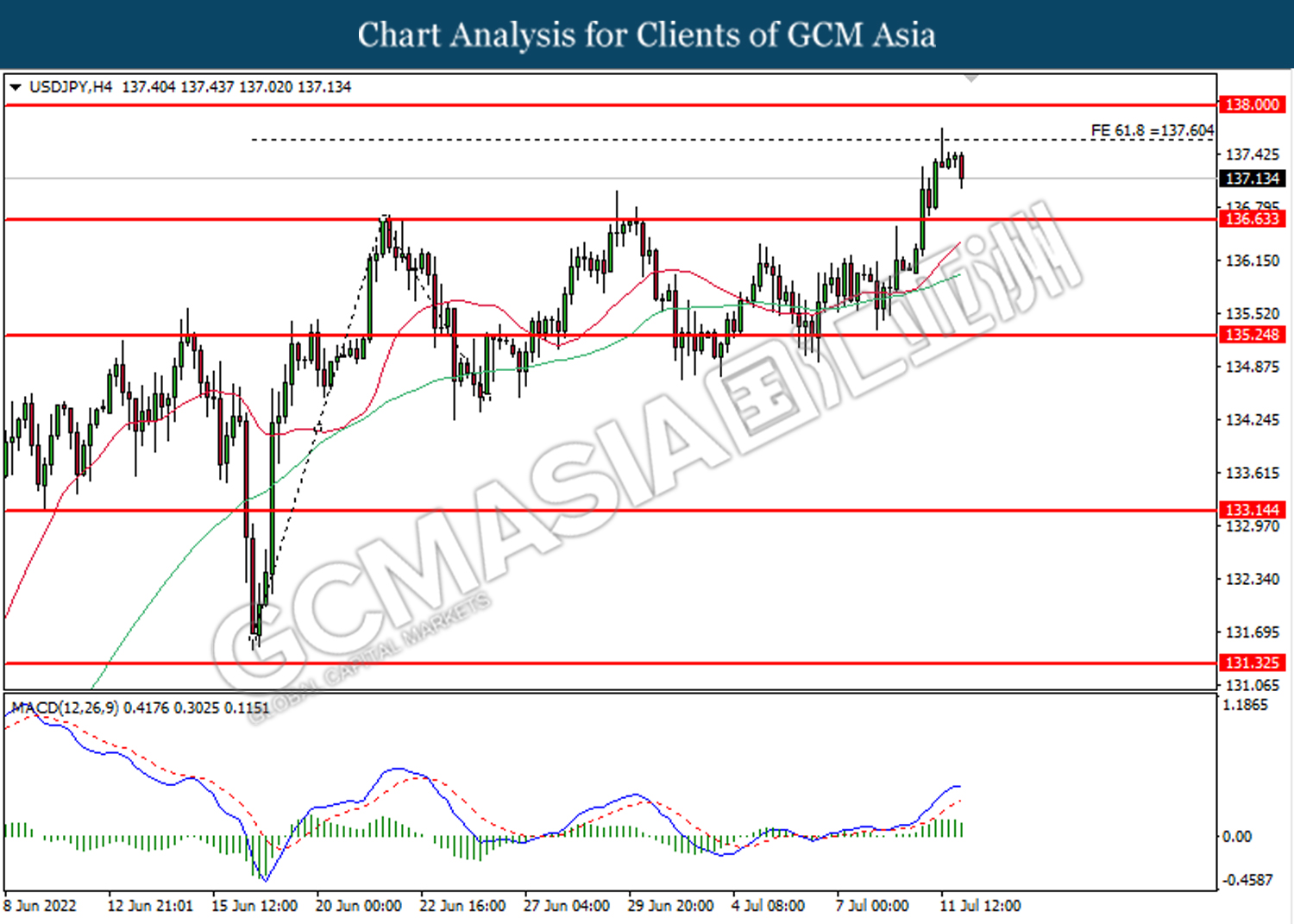

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 137.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 136.65.

Resistance level: 137.60, 138.00

Support level: 136.65, 135.25

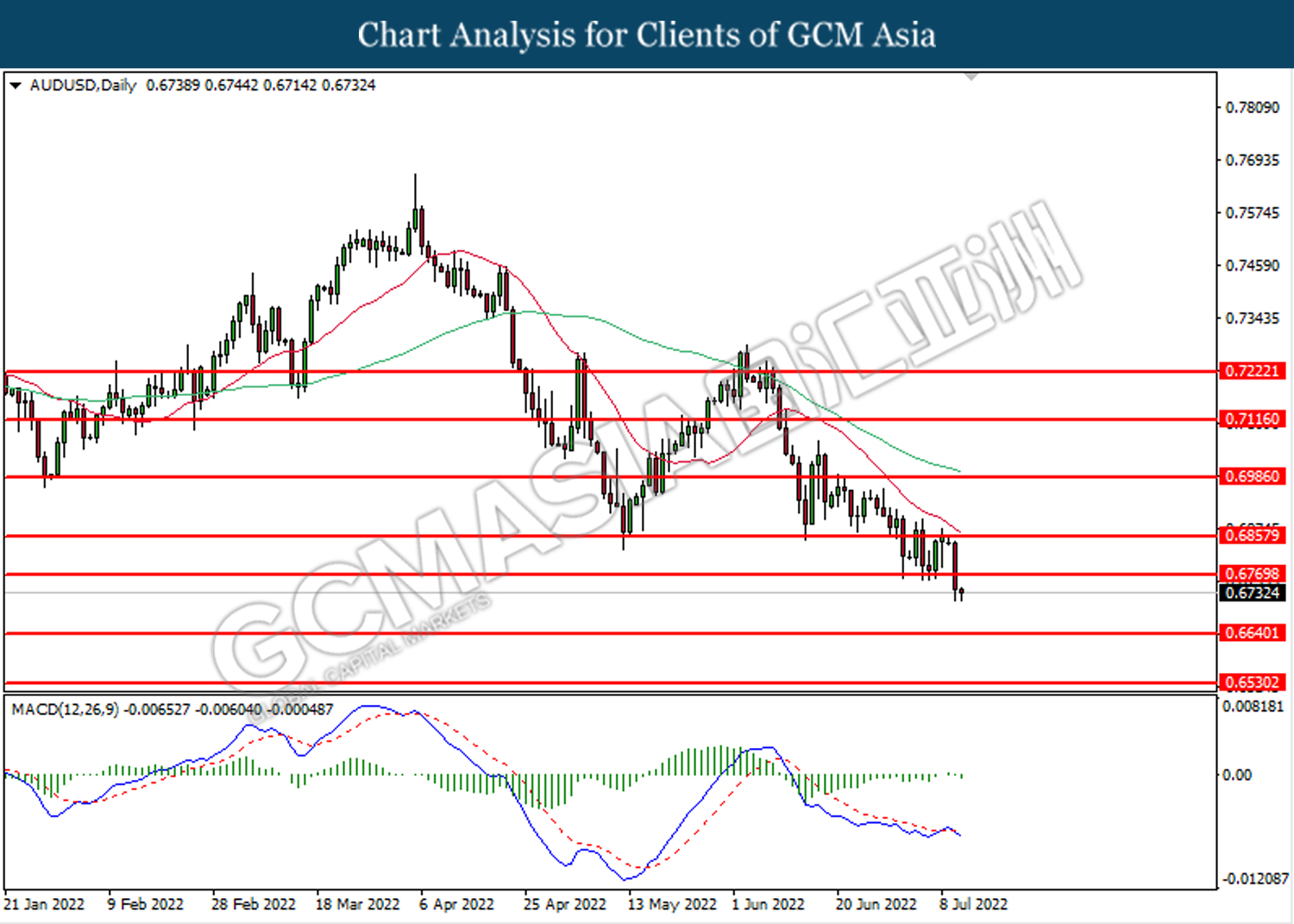

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6770. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6770, 0.6855

Support level: 0.6640, 0.6530

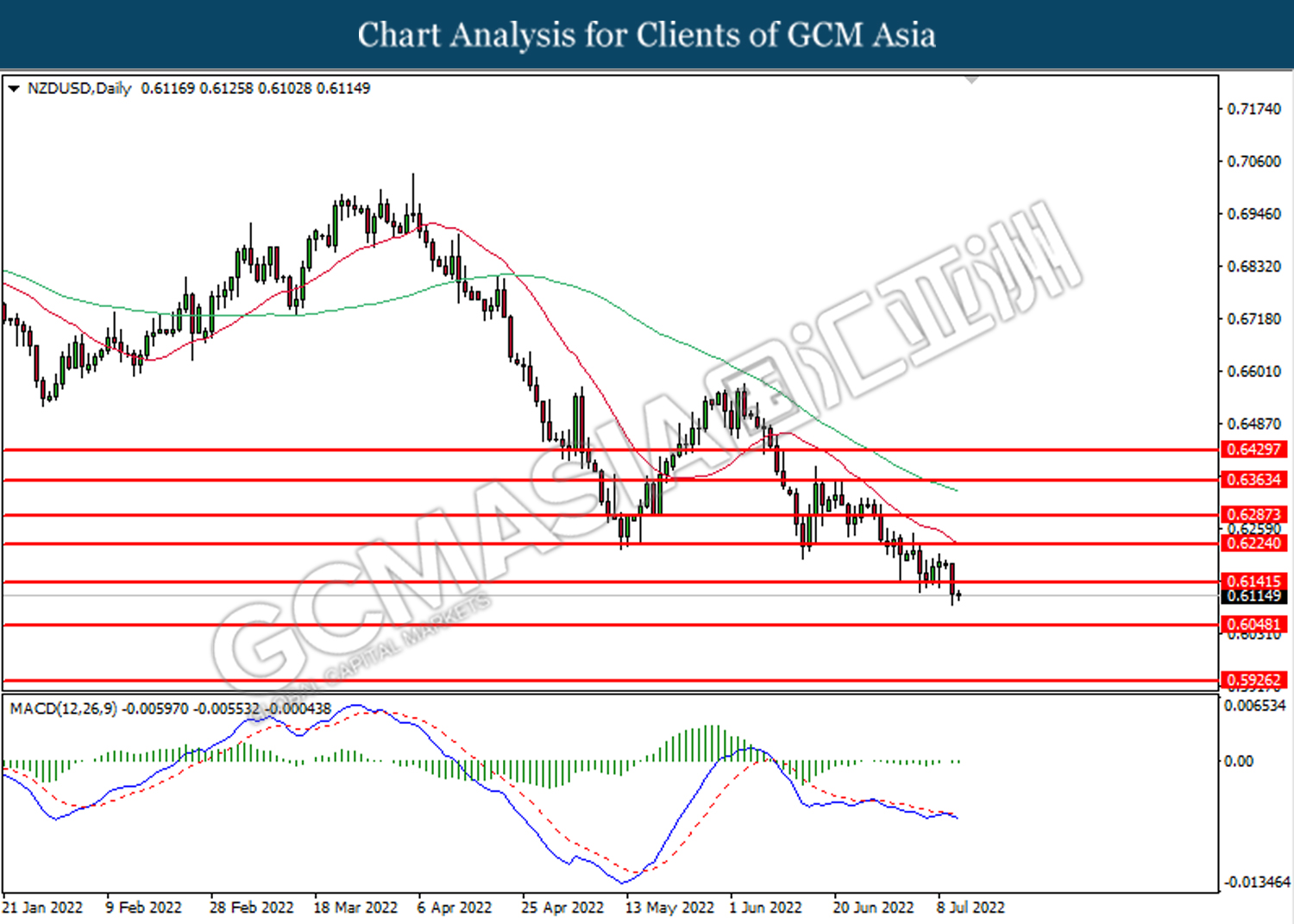

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6225

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2975. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3050.

Resistance level: 1.3050, 1.3110

Support level: 1.2975, 1.2910

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9825. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9825, 0.9890

Support level: 0.9750, 0.9665

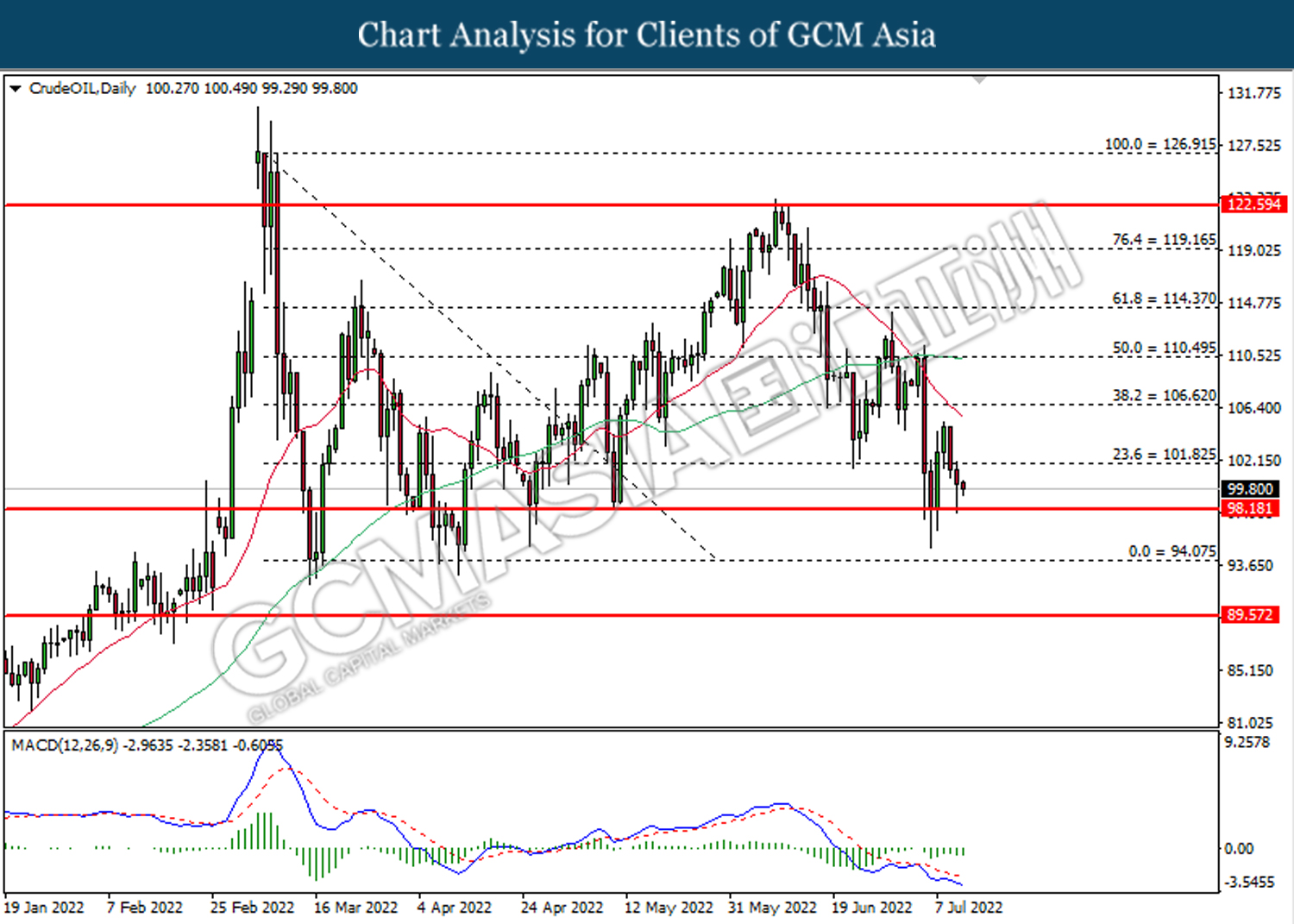

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 101.85. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 98.20.

Resistance level: 101.85, 106.60

Support level: 98.20, 94.05

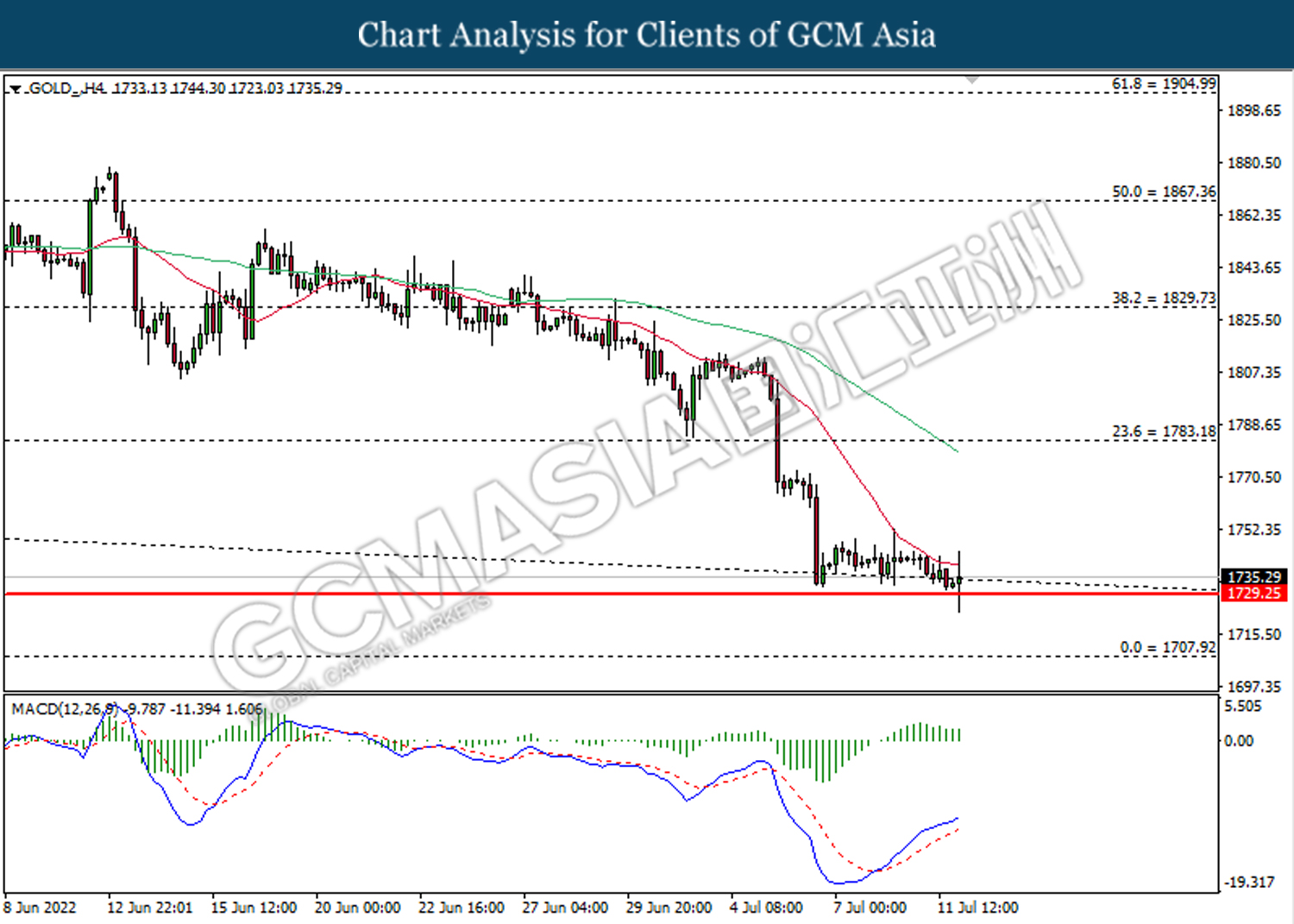

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1783.20.

Resistance level: 1783.20, 1829.75

Support level: 1729.25, 1707.90