9 August 2022 Afternoon Session Analysis

Sentiment in Pound market remains sour.

The Pound Sterling, which is widely traded by global investors, lingered near the lowest level since the outbreak of Covid-19 in March 2020. The majority of the market participants are still holding a pessimistic view toward the economic outlook of the UK amid the political uncertainty, where the New prime minister is still undecided yet. According to the latest news, Conservative MPS have chosen the final two British candidates, whereby the former Treasury secretary Rishi Sunak and the current foreign secretary Liz Truss is vying to succeed Boris Johnson. As of now, the candidates will continue with their election campaign, where Sunak and Truss will travel the country to make a series of speeches in order to gain support from the members of the Conservative party in the UK. According to the polls, it indicates that Rishi Sunak is in the “best place” to win over the United Kingdom in the upcoming election. The new prime minister is expected to be elected during the first week of September. As of writing, the pair of GBP/USD rose 0.02% to 1.2080.

In the commodities market, the crude oil price was down 0.36% to $90.30 a barrel amid the heightening of geopolitical tensions between the US and China continued to threaten the demand outlook of the commodity. Besides, the gold prices dropped -0.21% to $1785.40 per troy ounce after surging for $20 yesterday amid the ongoing tensions between the US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

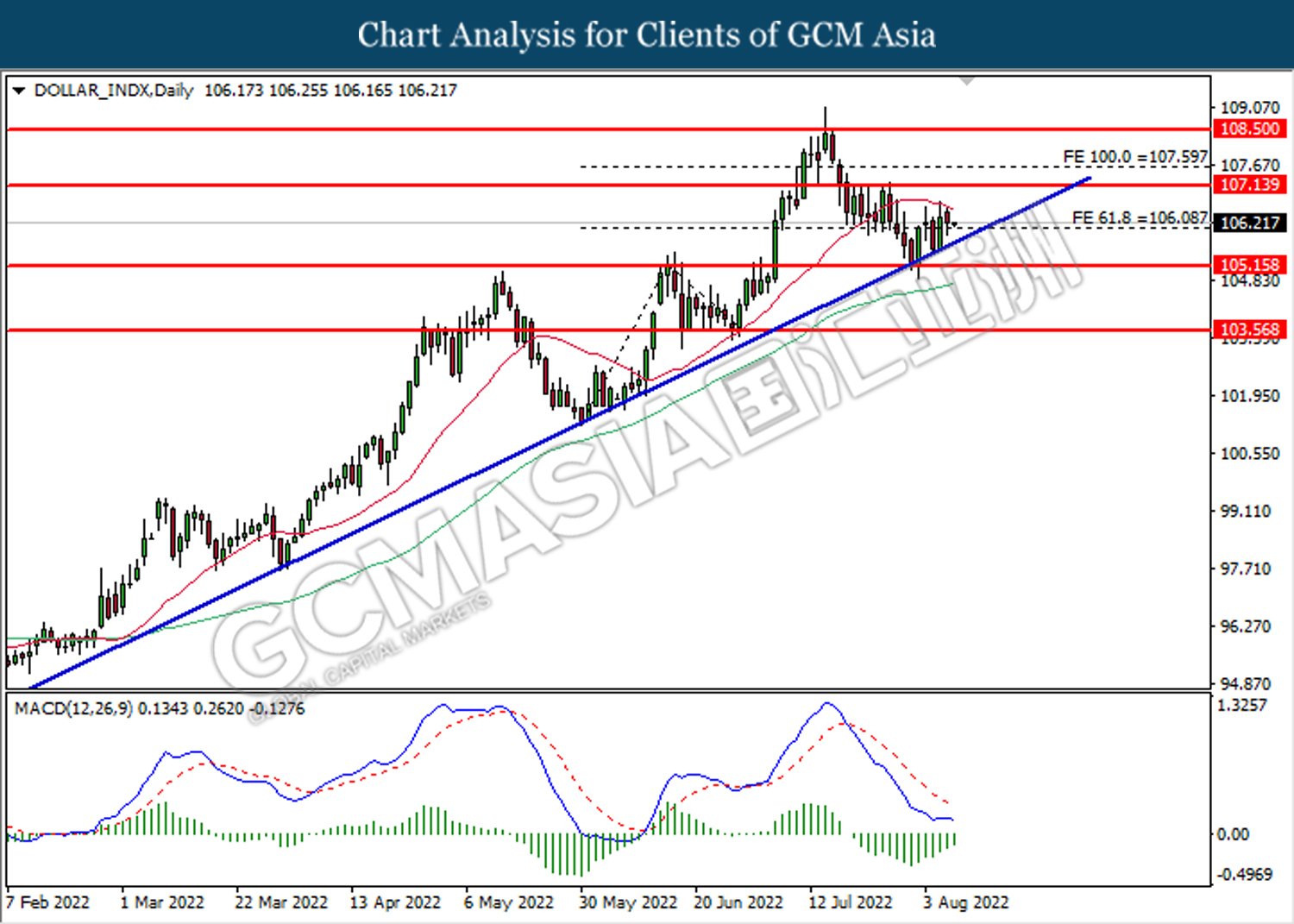

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

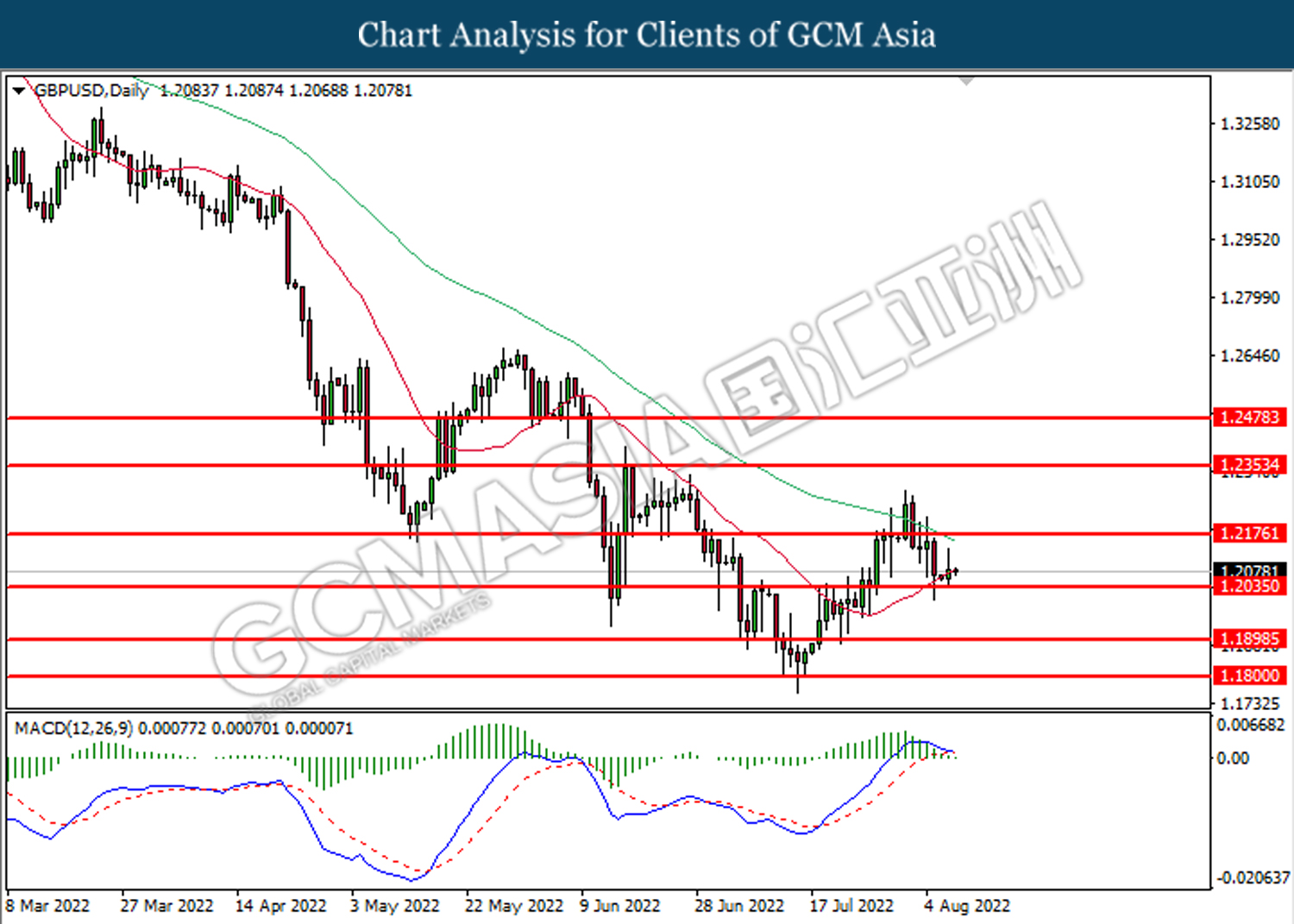

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2035. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

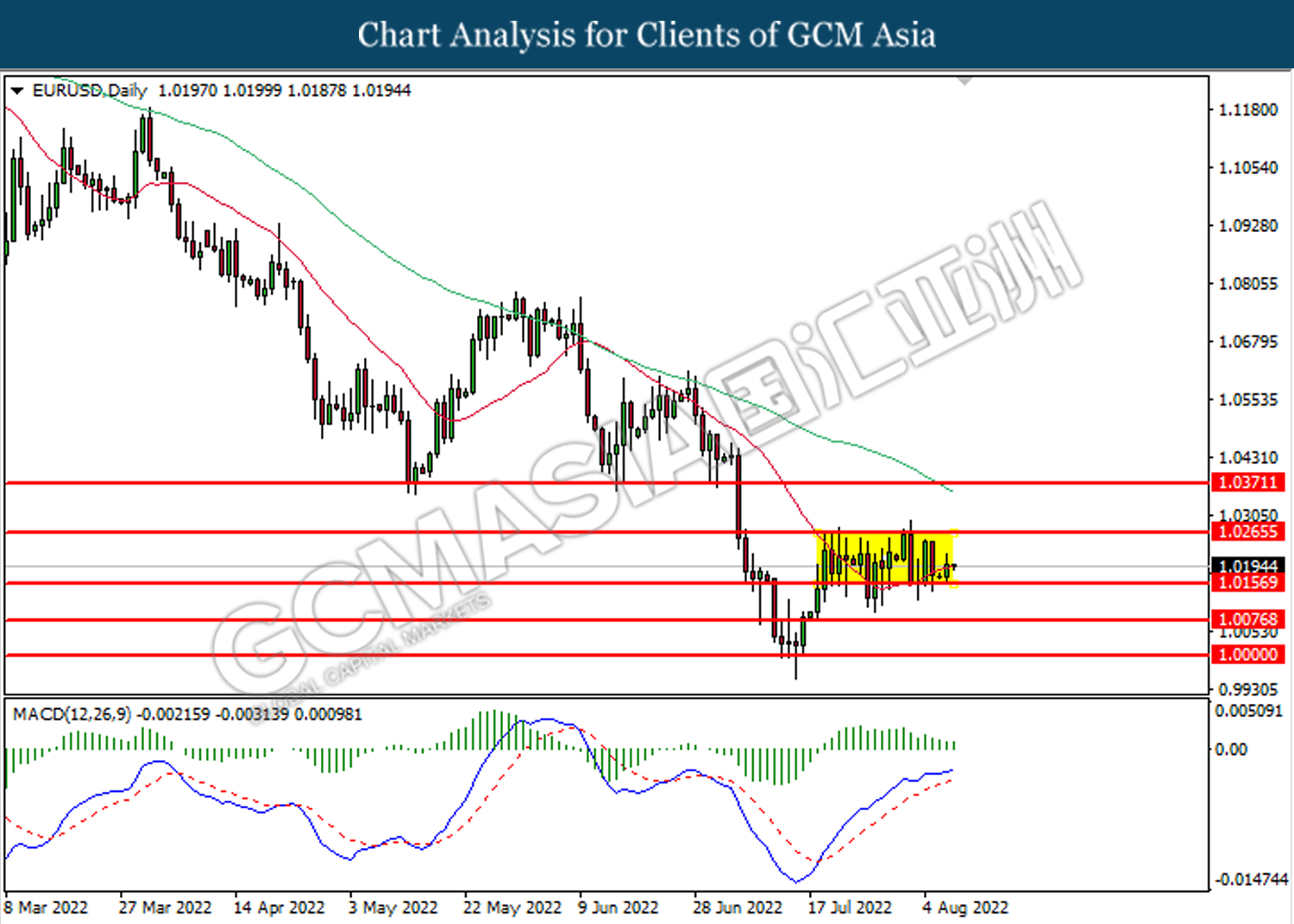

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

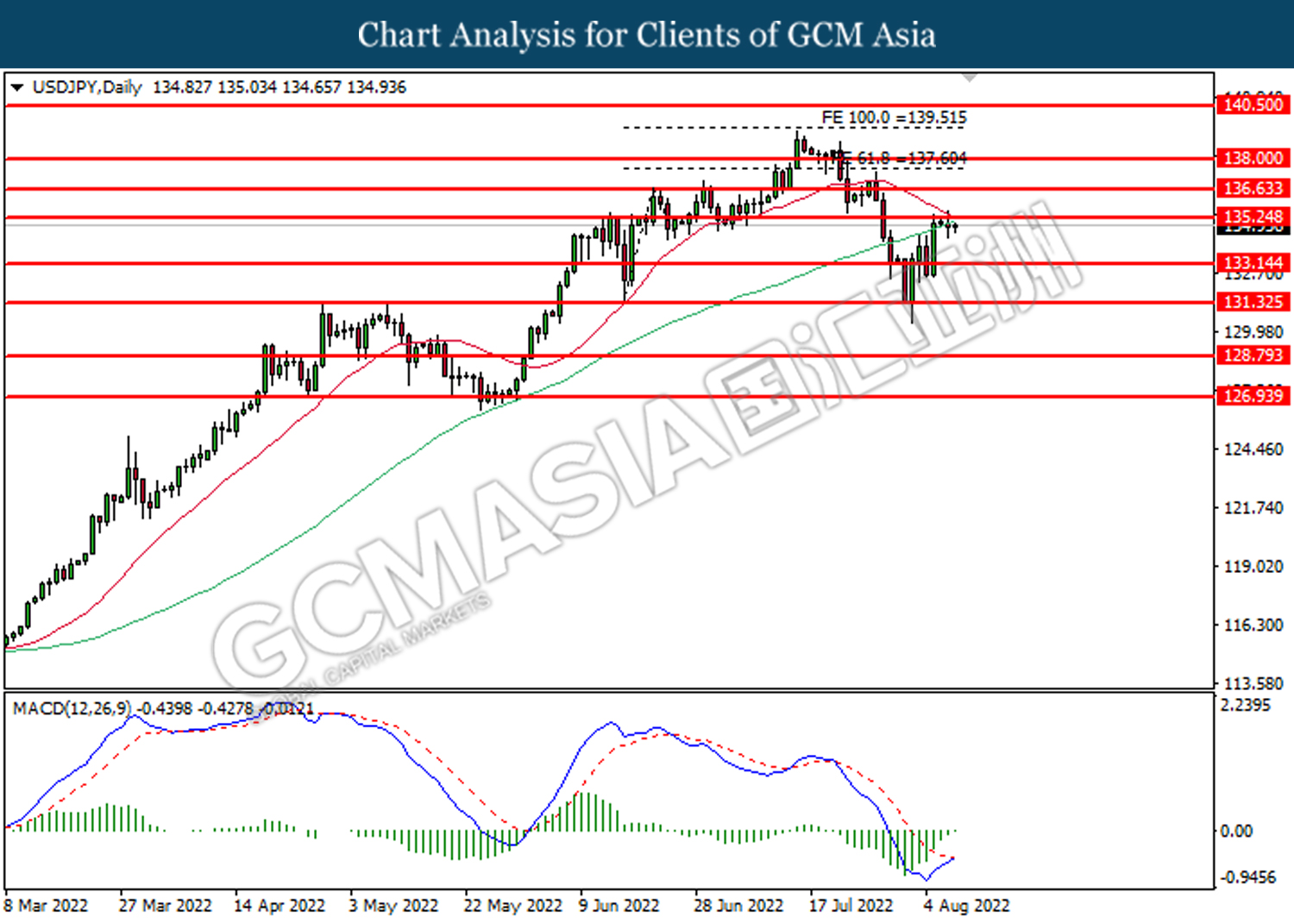

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

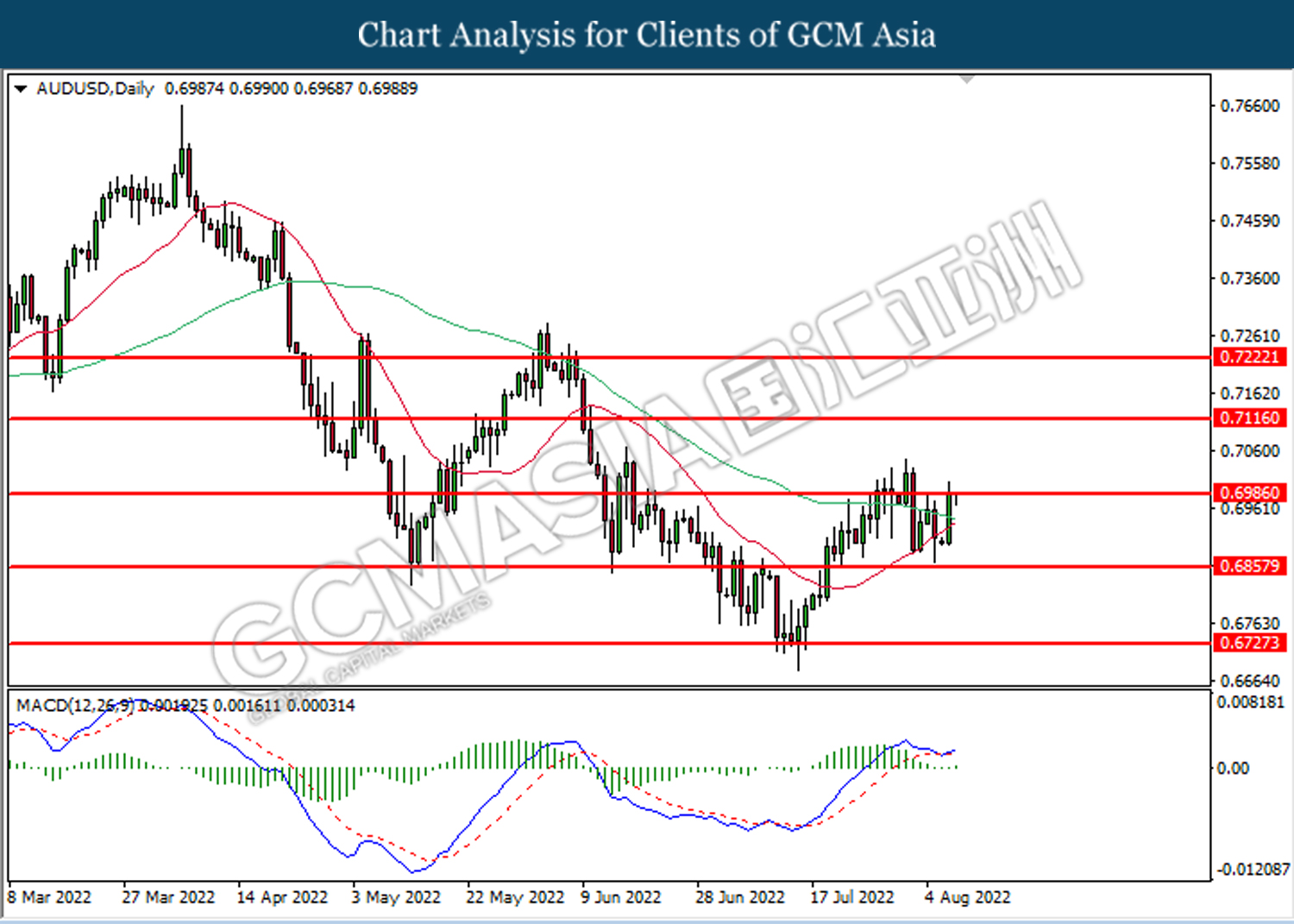

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

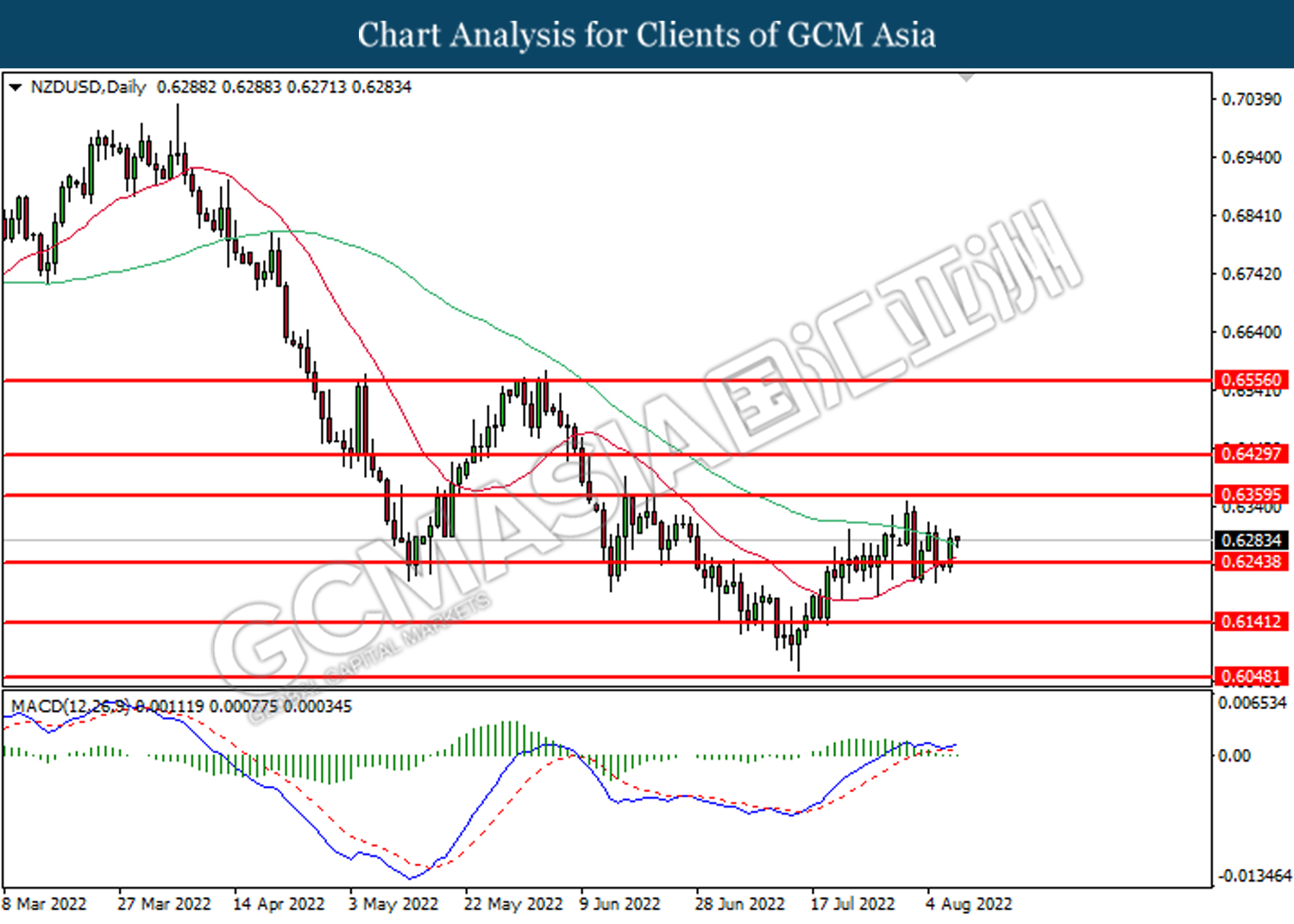

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

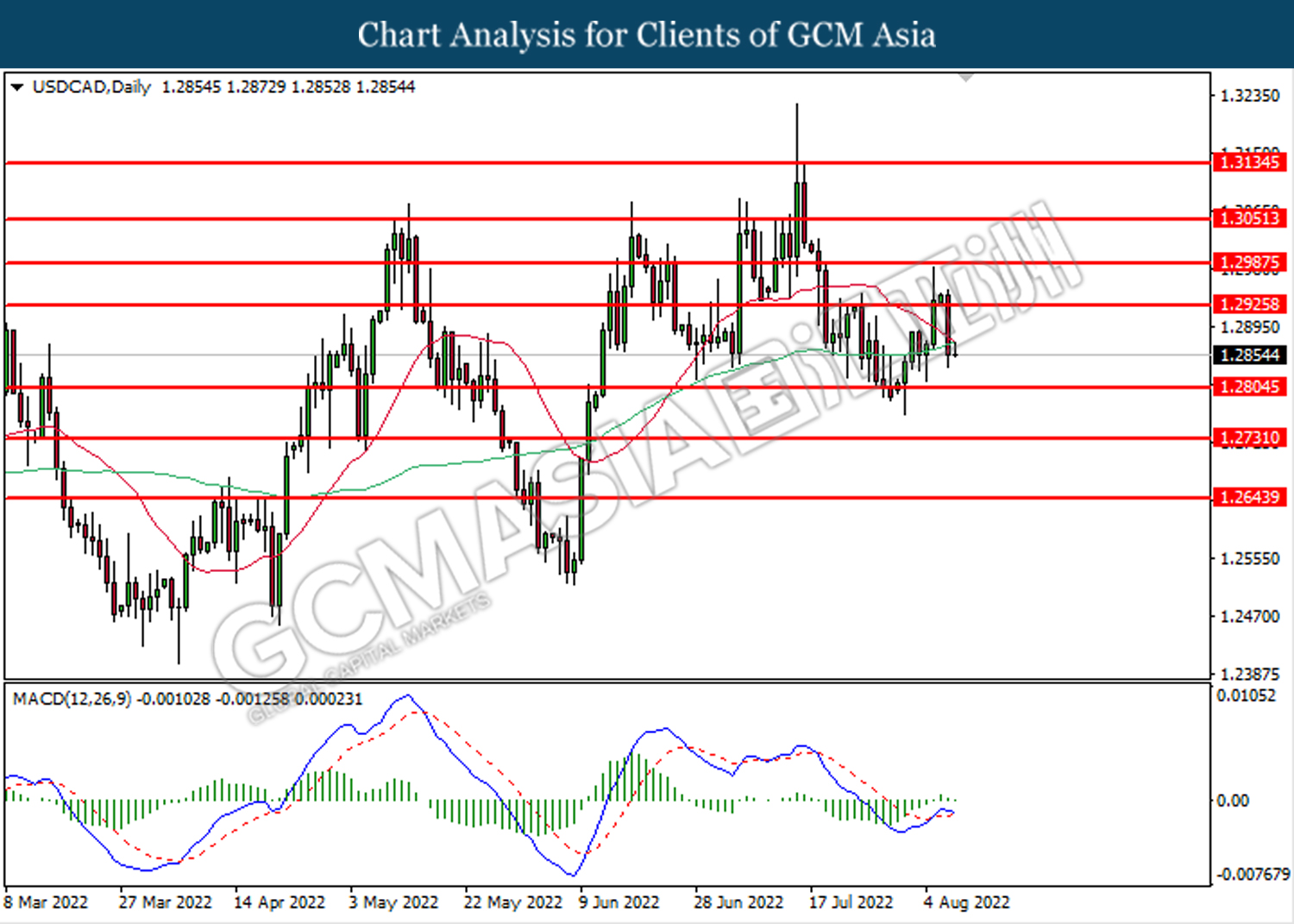

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2805.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

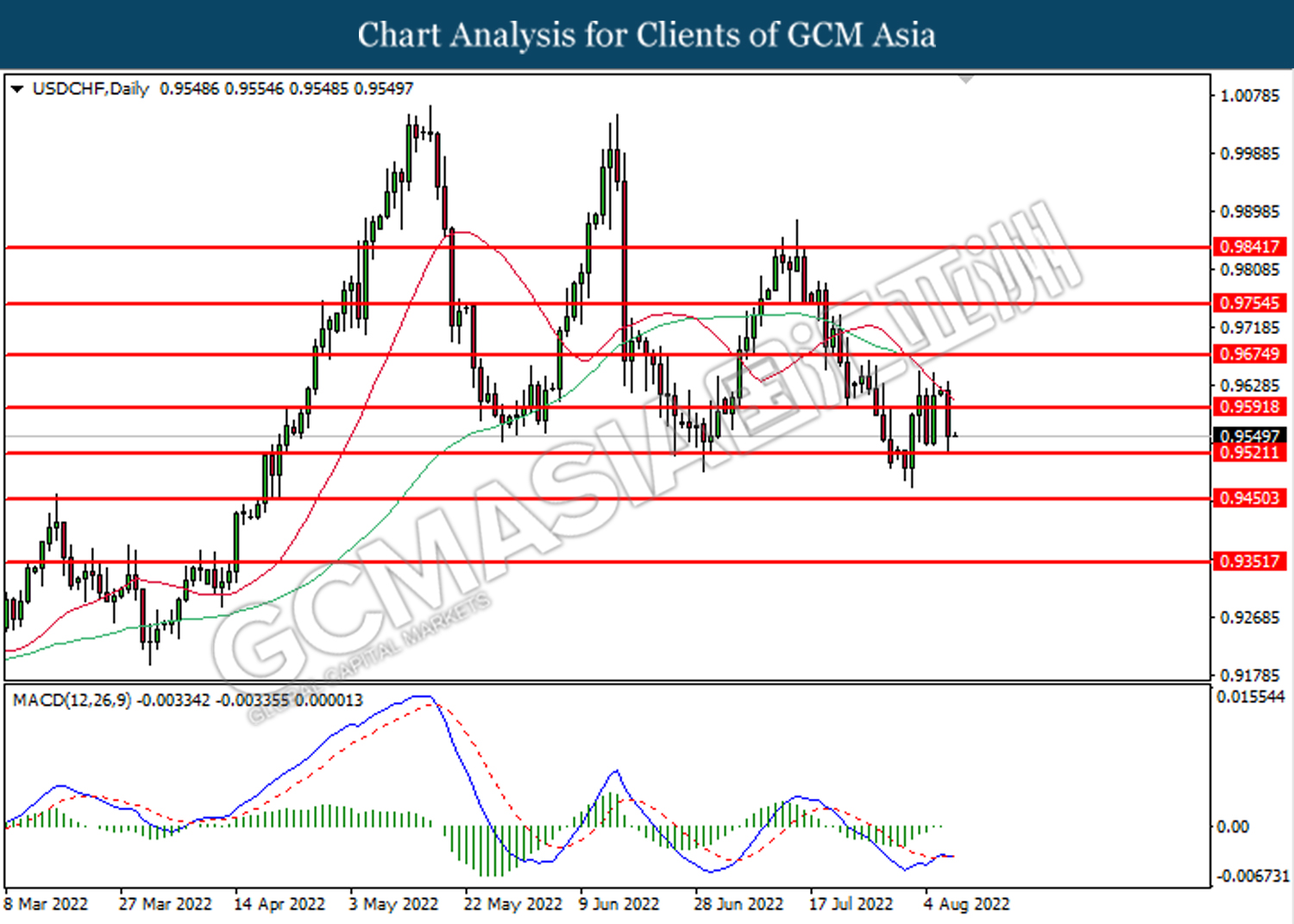

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

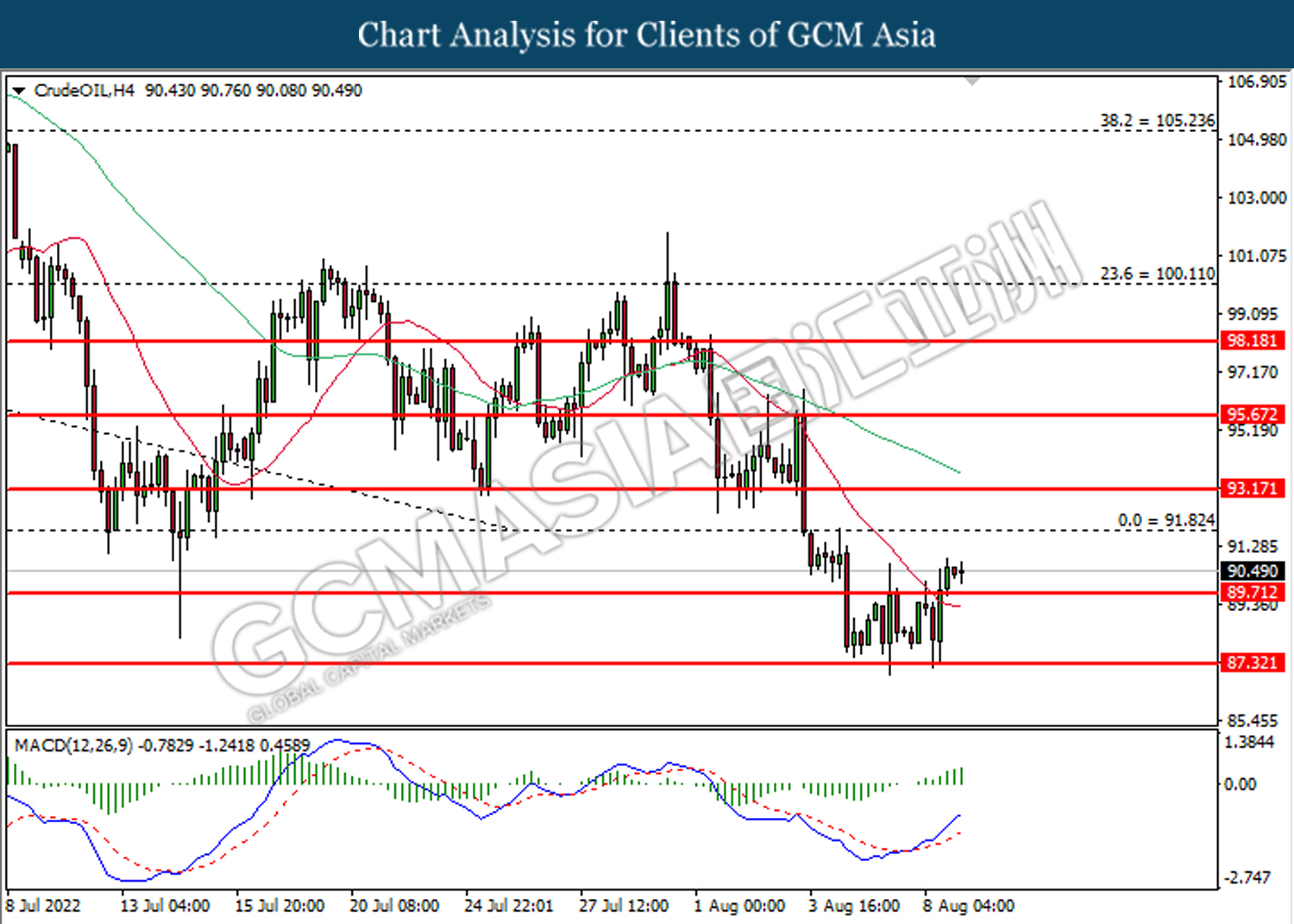

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.70. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 91.80.

Resistance level: 91.80, 93.15

Support level: 89.70, 87.30

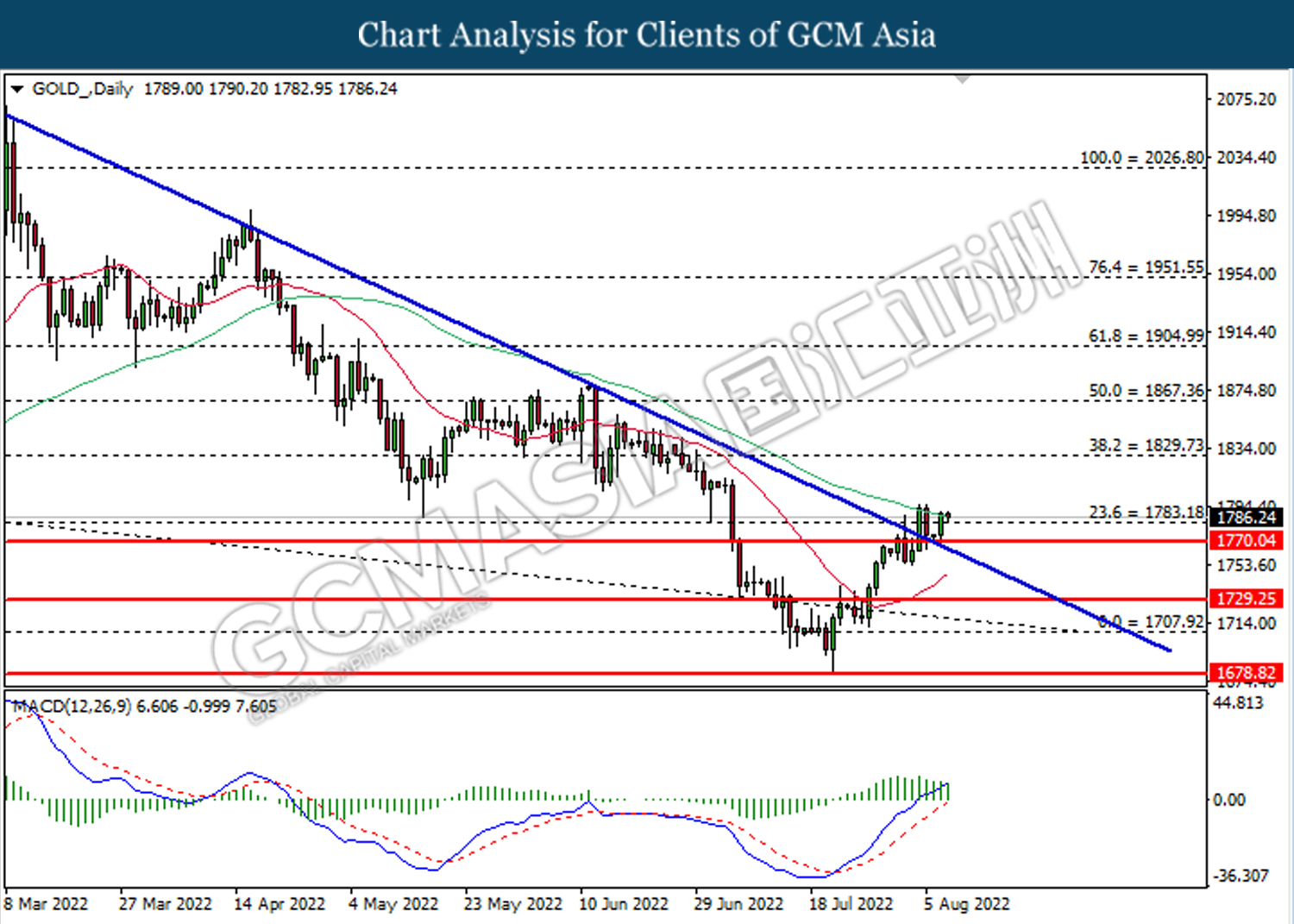

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1783.20. MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1829.75, 1867.35

Support level: 1783.20, 1770.05