23 June 2022 Morning Session Analysis

US Dollar beaten down over the economic recession fears.

The Dollar Index which traded against a basket of six major currencies retreated its overnight gains after Federal Reserve Chair Jerome Powell released his speech. According to Reuters, Jerome Powell has mentioned on Wednesday that the aggressive rate hike are painful, but it was the better means to stabilize inflation. He also emphasized that the Fed is not trying to engineer a recession to tackle inflation but is fully committed to bringing prices under control, even though it might lead to the economic downturn. Despite the implementation of rate hike would likely to combat inflation risk, it would also increase the borrowing cost while diminishing the consumer spending in US. Thus, it stoked a shift in market sentiment toward other currencies which could provide better return. As for now, investors would continue to scrutinize the latest updates with regards of economic data and rate hike decisions from Fed in order to gauge the likelihood movement of US Dollar. As of writing, the Dollar Index depreciated by 0.21% to 103.99.

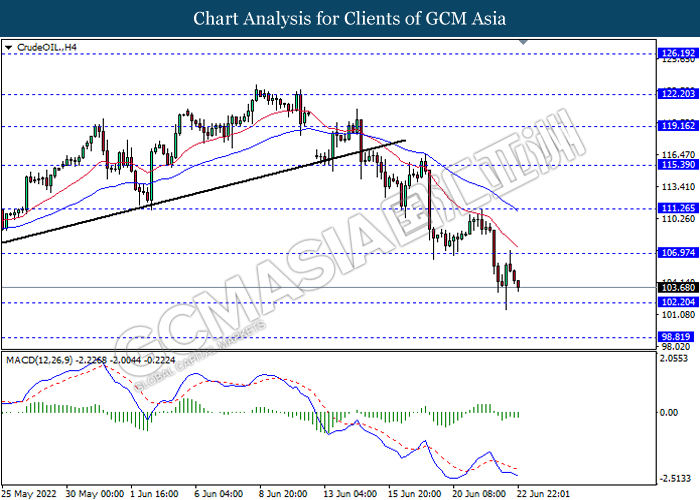

In commodities market, crude oil price slumped by 2.50% to $103.53 per barrel as of writing following the US API Weekly Crude Oil Stock increased 5.607M, exceeding the market forecast of -1.433M. Besides, gold price appreciated by 0.05% to $1839.25 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Jun) | 54.8 | 54.0 | – |

| 16:30 | GBP – Composite PMI (Jun) | 51.8 | 51.8 | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 54.6 | 54.6 | – |

| 16:30 | GBP – Services PMI (Jun) | 51.8 | 51.8 | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 225K | – |

| 23:00 | USD – Crude Oil Inventories | 1.956M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

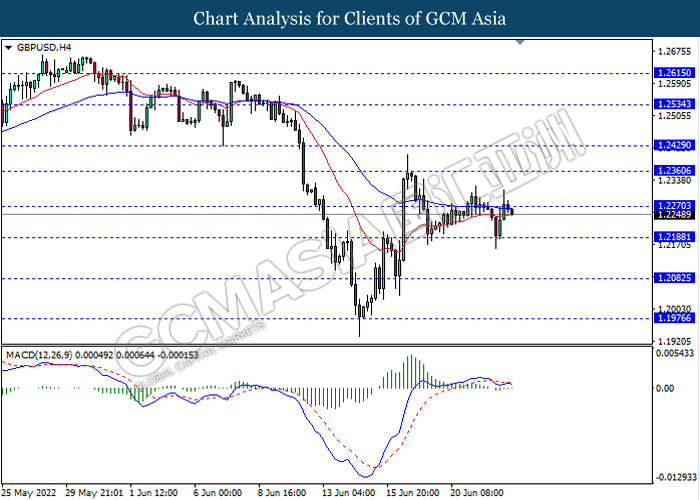

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

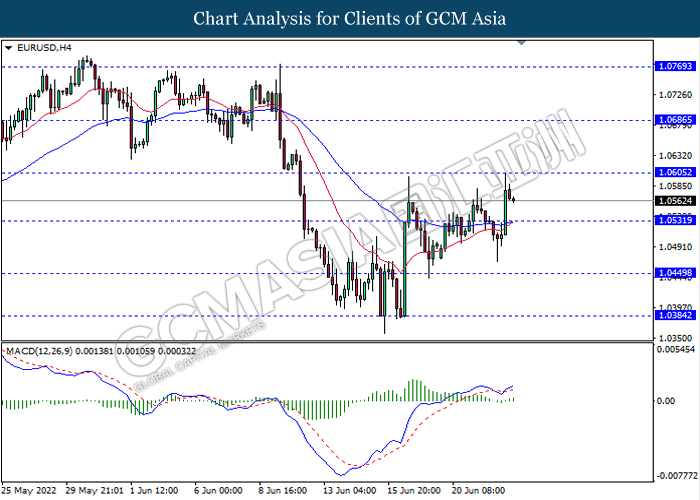

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0605, 1.0685

Support level: 1.0530, 1.0450

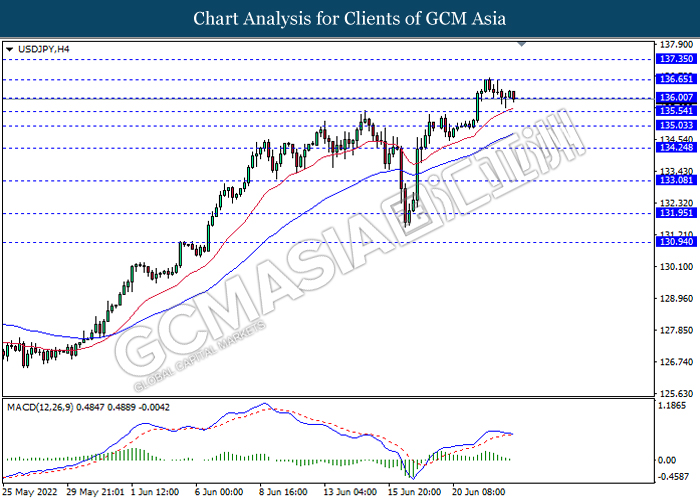

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 136.65, 137.35

Support level: 136.00, 135.55

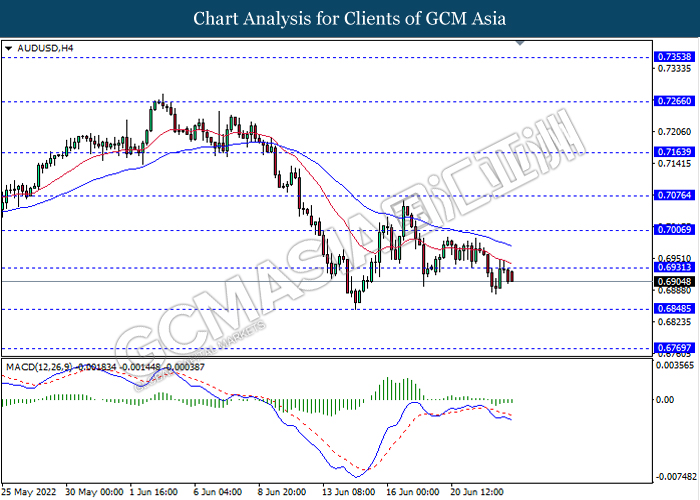

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

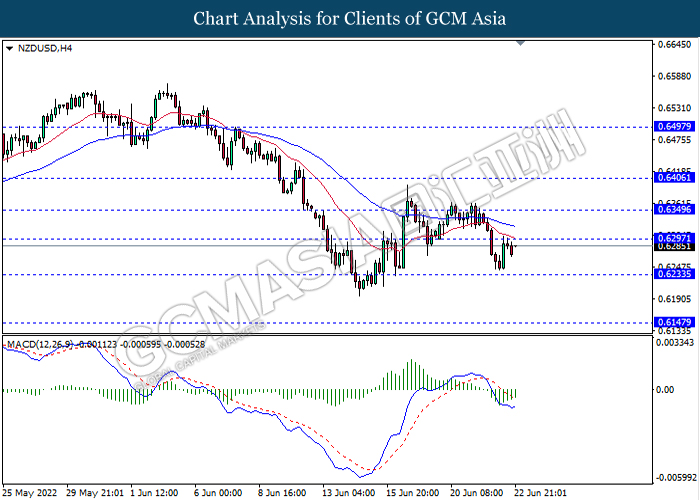

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

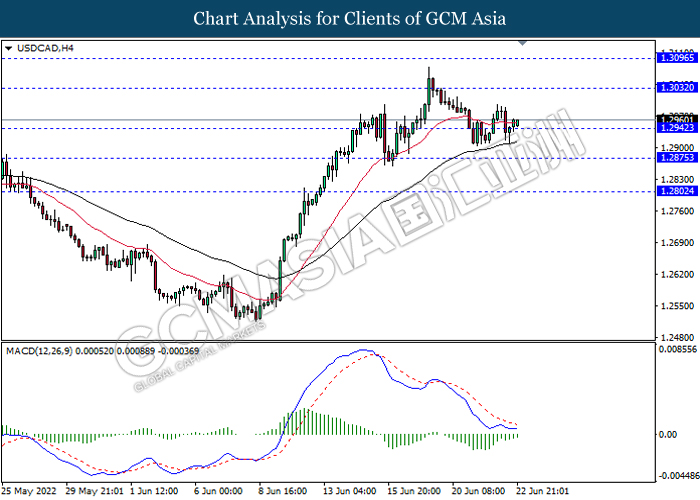

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3030, 1.3095

Support level: 1.2940, 1.2875

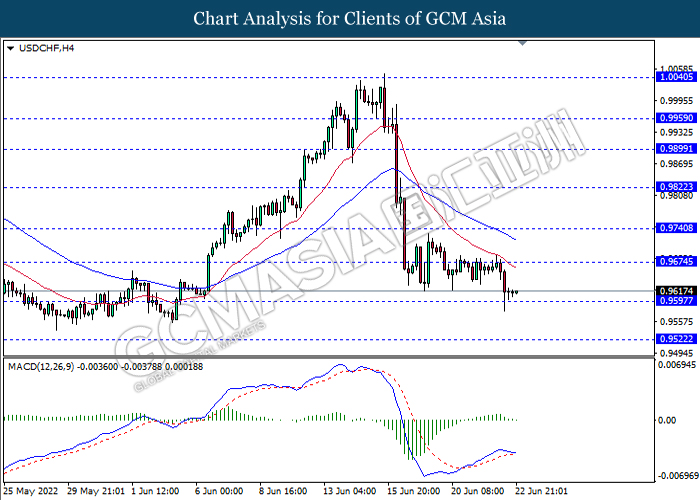

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 106.95, 111.25

Support level: 102.20, 98.80

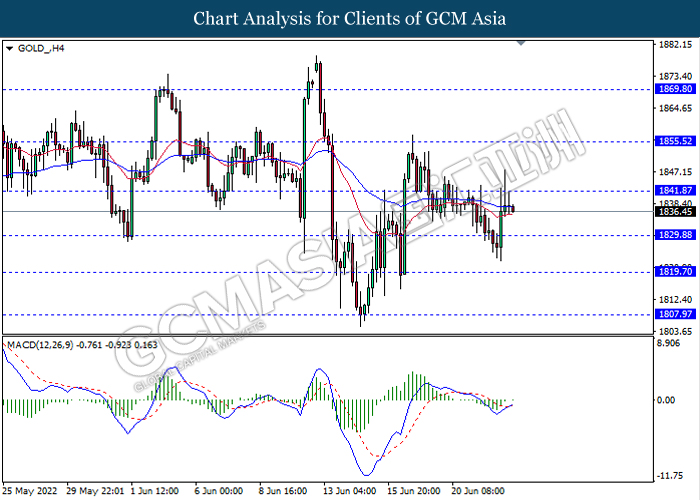

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1841.85, 1855.50

Support level: 1829.90, 1819.70