1 June 2017 Daily Analysis

Sterling stumbles, greenback tumbles.

US dollar dwindles near recent six-months low while pound sterling slipped as latest opinion poll showed trimmed support for Prime Minister Theresa May’s ruling party before next week’s national election. The greenback slipped to sessions low on yesterday following softer US pending home sales data which illustrates lagging outlook for housing market. Such reading has spook off some dollar-bulls which are looking forward for next interest rate hike which could be initiated as soon as next FOMC meeting on June 13th. The dollar index was last seen at around 96.90, not far from six-months low of 96.65. Likewise, pound sterling remained under pressure from yesterday’s YouGov which reported that May’s Conservative Party is leading with only 3 percentage point difference as compared to the opposition Labor Party. Such reading gave pessimistic undertone to the market whereby she might fall short of a majority support during next week’s election. Pairing of GBP/USD eased 0.08% to $1.2880.

Peering into the commodities, crude oil price rose 0.97% to $48.79 after the US industry report showed a larger draw in crude stockpiles. According to American Petroleum Institute, crude inventories for week ended May 26th was down 8.7 million barrels, larger than prior expected decrease of only 2.5 million barrels. Otherwise, gold price was down 0.36% to $1,267.44 as greenback mends its prior session losses during Asian trading hours.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | AUD – Private New Capital Expenditure (QoQ) (Q1) | -2.1% | 0.8% | 0.3% |

| 09:30 | AUD – Retail Sales (MoM) (Apr) | -0.1% | 0.3% | 1.0% |

| 09:45 | CNY – Caixin Manufacturing PMI (May) | 50.3 | 50.1 | 49.6 |

| 15:55 | EUR – German Manufacturing PMI (May) | 59.4 | 59.4 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 57.3 | 56.5 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 177K | 185K | – |

| 20:30 | USD – Initial Jobless Claims | 234K | 239K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 54.8 | 54.5 | – |

| 23:00 | Crude Oil – Crude Oil Inventories | -4.432M | -2.517M | – |

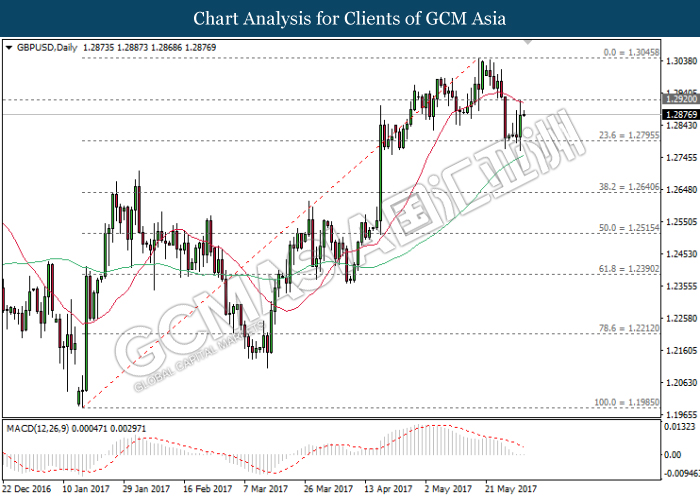

GBPUSD

GBPUSD, Daily: GBPUSD were traded lower following prior retrace near the 20-moving average line at 1.2920. With regards to MACD indicator which continues to hover outside of upward momentum, GBPUSD is expected to continue its oscillation in between the range of 1.2920 and 1.2795 in short-term. Long-term trend direction still suggests an upward trend ahead after a closure above the resistance level of 1.2920.

Resistance level: 1.2920, 1.3045

Support level: 1.2795, 1.2640

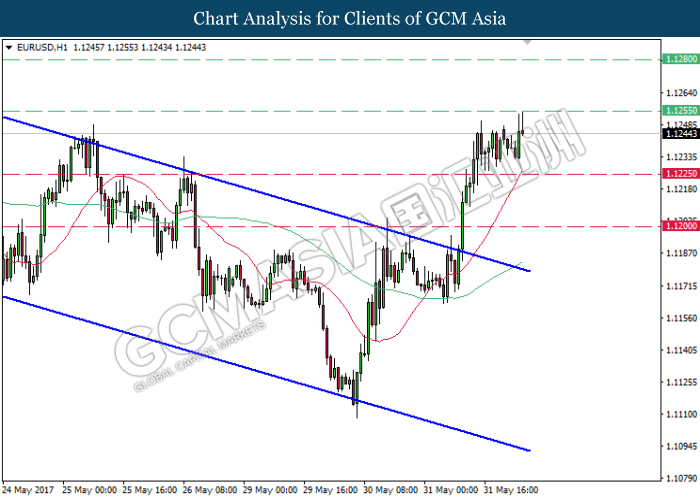

EURUSD

EURUSD, H1: EURUSD has recently broke out from the top level of downward channel, signaling a change in trend direction to move further upwards. As both MA lines continue to expand upwards, a successful closure above the resistance level of 1.1255 would suggest an extension of uptrend for EURUSD.

Resistance level: 1.1255, 1.1280

Support level: 1.1225, 1.1200

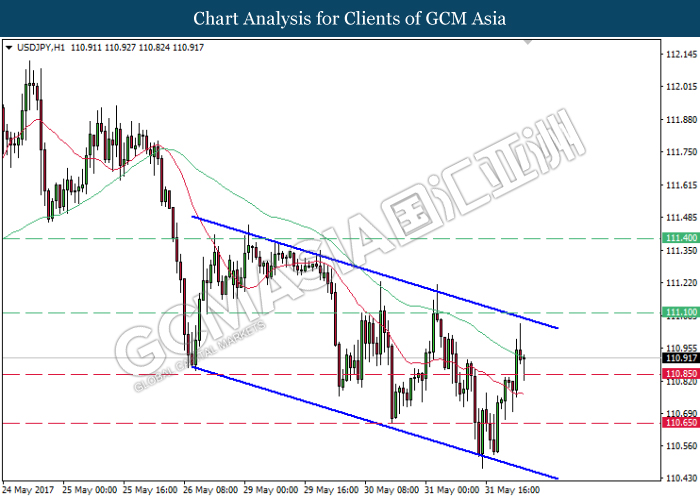

USDJPY

USDJPY, H1: USDJPY remained traded within a downward channel following prior retrace from the top level. Recent closure below the 60-moving average line (green) suggest USDJPY to move further downwards after successfully closing below the support level of 110.85.

Resistance level: 111.10, 111.40

Support level: 110.85, 110.65

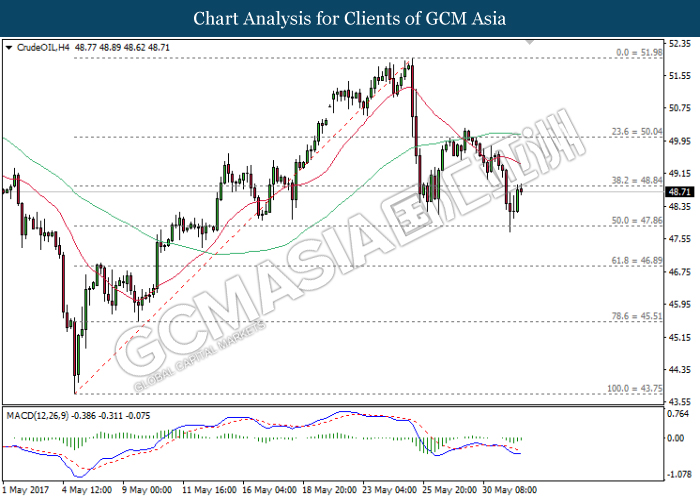

CrudeOIL

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level of 47.85. As the downward signal from MACD histogram begins to diminish, crude oil price may extend its current upward momentum after breaking the resistance level of 48.85.

Resistance level: 48.85, 50.05

Support level: 47.85, 46.90

GOLD

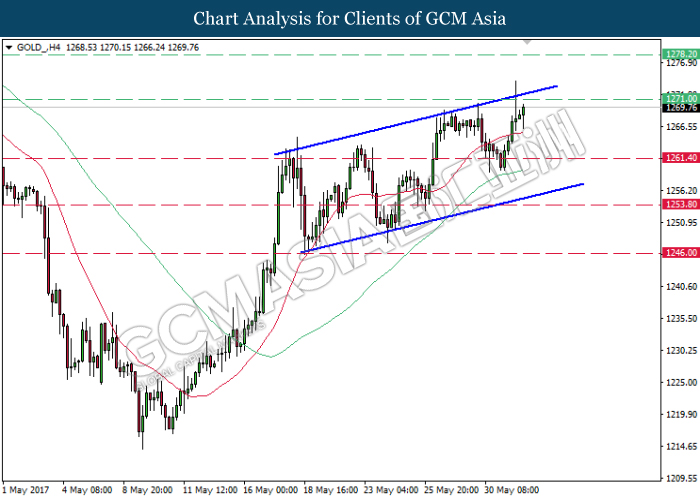

GOLD_, H4: Gold price was traded higher following prior rebound from the 60-moving average line (green). Recent closure above the 20-moving average line (red) suggests gold price to move further upwards towards the target of resistance level at 1271.00. A breakout from the top level of upward channel would signal a change in trend direction to move further up thereafter.

Resistance level: 1271.00, 1278.20

Support level: 1261.40, 1253.80, 1246.00