1 June 2021 Afternoon Session Analysis

Pound soars on optimism towards economy.

The pound sterling which traded against the dollar and other currency pairs have experience a huge bid and rose to a three year high following markets continue to bet on faster economic recovery in the U.K amid strong vaccine rollout. According to data collected by Johns Hopkins University and Bloomberg, three-fourths of the U.K population will be covered with a two-dose vaccine in a month based on the current pace of vaccination. On top of that, the pound sterling also received further support following expectation of U.K authorities to fully reopen the economy on June 21. Despite with the risk of India variant coronavirus in the U.K, U.K Prime Minister Boris Johnson stated that there is no conclusive reason to delay the easing of lockdown. At the time of writing, GBP/USD rose 0.23% to 1.4239.

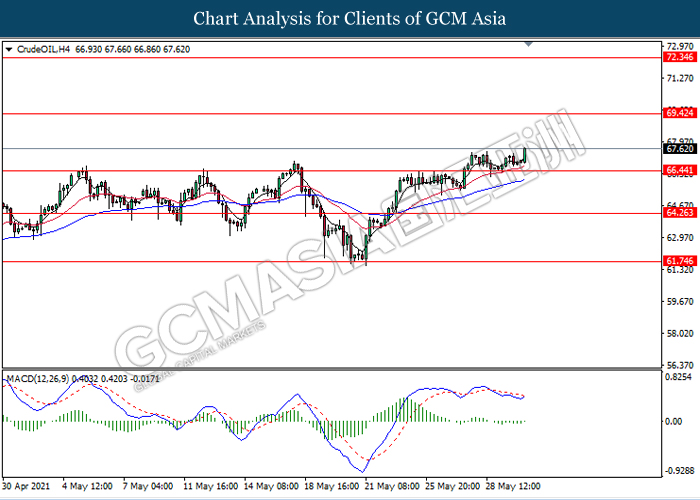

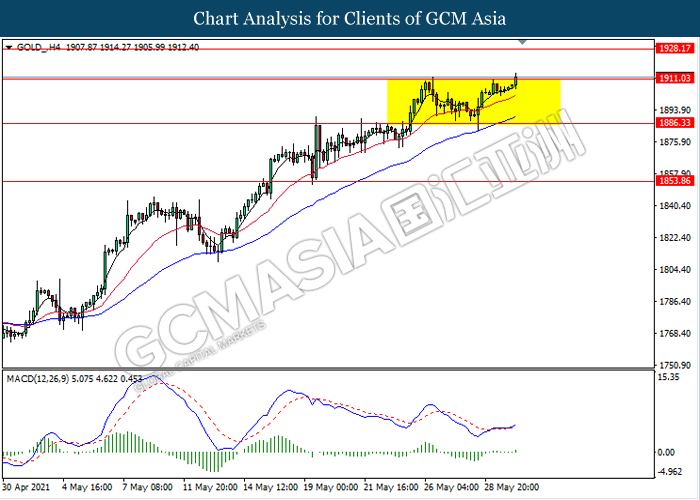

In the commodities market, crude oil price jumps 1.18% to $67.64 per barrel as of writing following OPEC forecast of tightening market. According to reports, an OPEC+ committee predicted that the oil glut built up during the Covid-19 pandemic has almost gone, and that stockpiles will diminish rapidly in the second half of the year. The alliance is expected to ratify a scheduled output increase in July when it meets later on Tuesday. On the other hand, gold price rose 0.28% to $1912.58 a troy ounce at the time of writing following ongoing dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

23:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jun) | 0.10% | 0.10% | – |

| 15:55 | EUR – German Manufacturing PMI (May) | 64.0 | 64.0 | – |

| 15:55 | EUR – German Unemployment Change (May) | 9K | -9K | – |

| 16:30 | GBP – Manufacturing PMI (May) | 66.1 | 66.1 | – |

| 17:00 | EUR – CPI (YoY) (May) | 1.6% | 1.9% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 0.4% | 1.0% | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 60.7 | 60.7 | – |

Technical Analysis

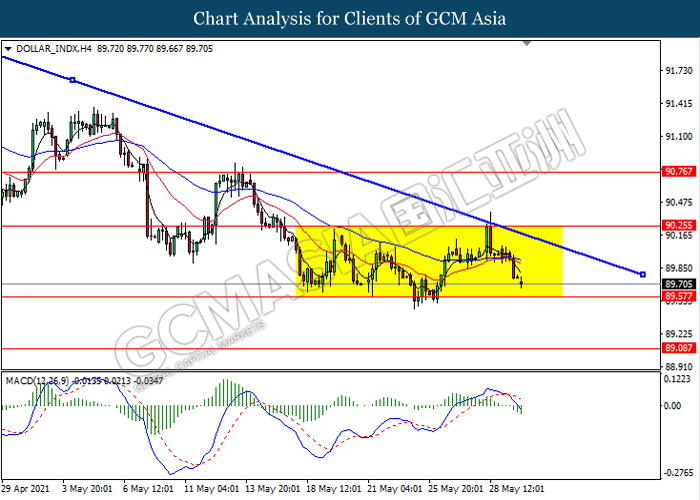

DOLLAR_INDX, H4: Dollar remain traded in a sideway channel while currently testing near the support level 89.55. However, MACD which illustrate bearish bias signal with the formation of death cross suggest the dollar to extend its losses after it breaks below the support level.

Resistance level: 90.25, 90.75

Support level: 89.55, 89.10

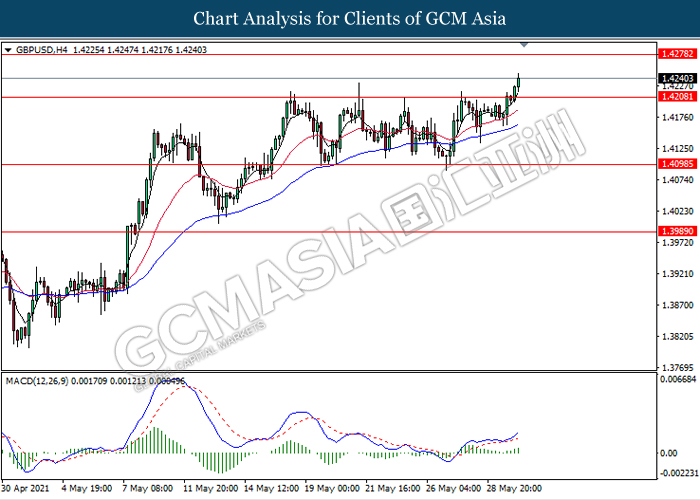

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level 1.4210. MACD which illustrate bullish momentum signal suggest the pair to extend its gains towards the resistance level 1.4280.

Resistance level: 1.4280, 1.4370

Support level: 1.4210, 1.4100

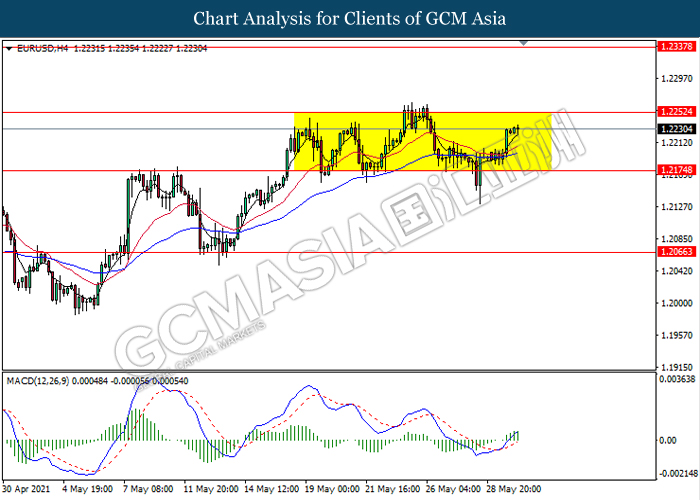

EURUSD, H4: EURUSD remain traded in a sideway channel following recent rebound from the support level 1.2175. However, MACD which illustrate bullish momentum signal with the recent formation of golden cross suggest the pair to be traded higher in short term towards the resistance level 1.2250.

Resistance level: 1.2250, 1.2335

Support level: 1.2175, 1.2065

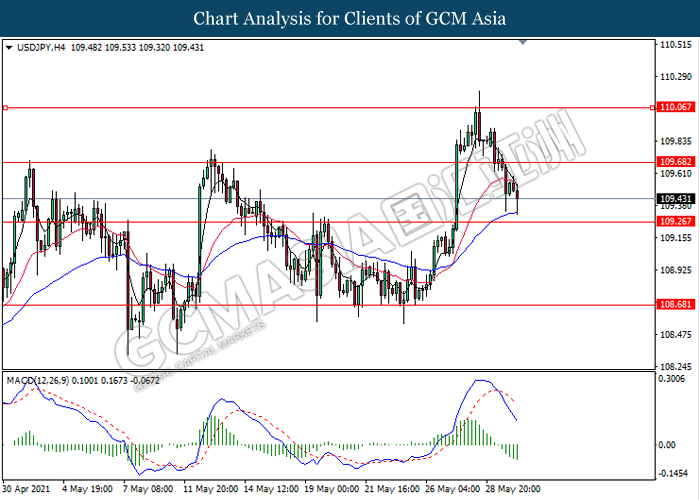

USDJPY, H4: USDJPY was traded lower following recent retracement from its high level. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 109.25.

Resistance level: 109.70, 110.05

Support level: 109.25, 108.70

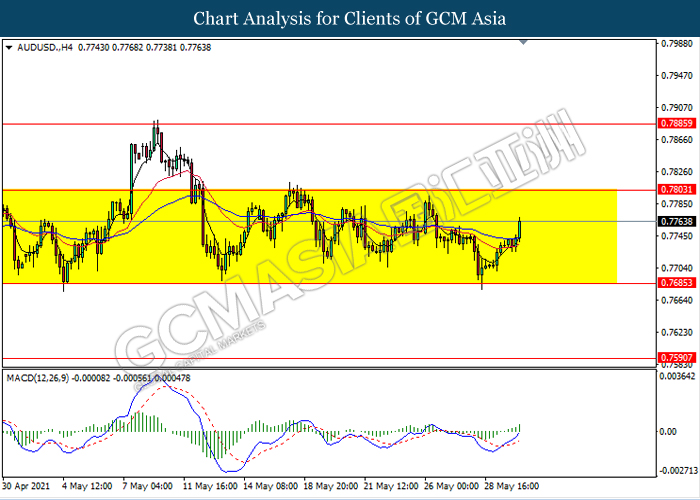

AUDUSD, H4: AUDUSD remain traded in a sideway channel following recent rebound from the support level 0.7685. However, MACD which illustrate bullish momentum signal with the recent formation of golden cross suggest the pair to extend its rebound in short term towards the resistance level 0.7805.

Resistance level: 0.7805, 0.7885

Support level: 0.7685, 0.7590

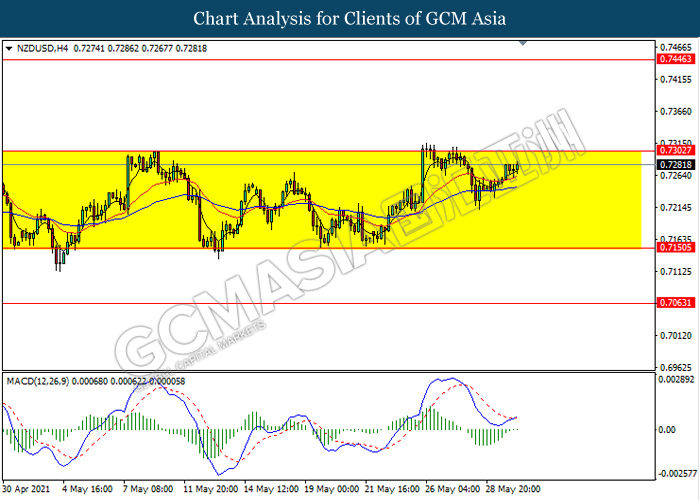

NZDUSD, H4: NZDUSD remain traded in a sideway channel while currently testing near the resistance level 0.7300. However, MACD which illustrate diminishing bearish momentum signal with the formation of golden cross suggest the pair to be traded higher after it breaks above the resistance level 0.7300.

Resistance level: 0.7300, 0.7445

Support level: 0.7150, 0.7065

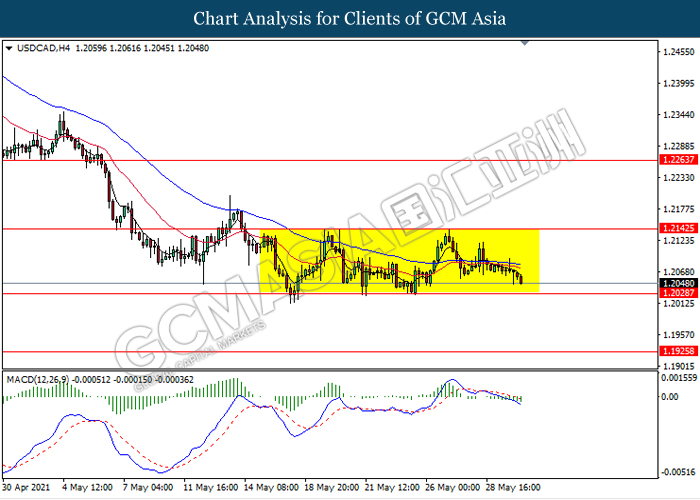

USDCAD, H4: USDCAD remain traded in a sideway channel while currently testing near the support level 1.2030. However, MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.2140, 1.2265

Support level: 1.2030, 1.1925

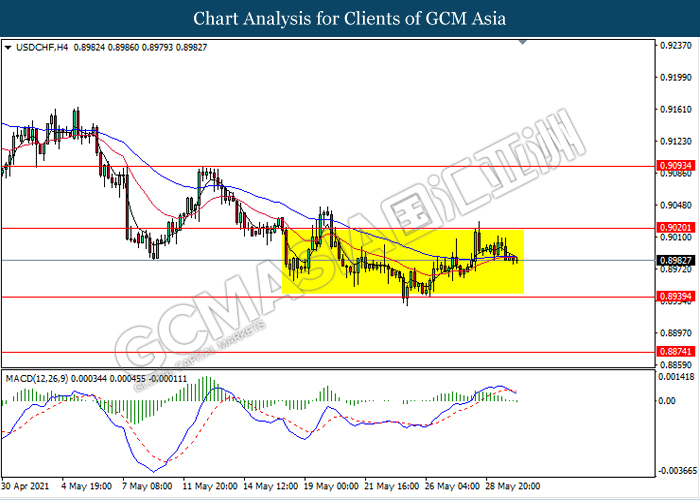

USDCHF, H4: USDCHF remain traded in a sideway channel following recent retracement from its high level. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 0.8940.

Resistance level: 0.9020, 0.9095

Support level: 0.8940, 0.8875

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 66.45. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains towards the resistance level 69.40.

Resistance level: 69.40, 72.35

Support level: 66.45, 64.25

GOLD_, H4: Gold price remain traded in a sideway channel while currently testing the resistance level 1911.05. However, MACD which illustrate bullish bias signal with the recent formation of golden cross suggest the commodity to be traded higher after it breaks above the resistance level.

Resistance level: 1911.05, 1928.15

Support level: 1886.35, 1853.85