01 June 2023 Morning Session Analysis

Dollar surged amid the stronger-than-expected JOLTs job data.

The dollar index, which was traded against a basket of six major currencies, managed to extend its gains and hit its 11-week highs yesterday as the upbeat labor data boosted the market sentiment in the US. According to the Bureau of Labor Statistics, the US JOLTs Job Openings data rose from the prior reading of 9.745M to 10.103M this month, significantly higher than the consensus forecast at 9.775M, signaling that the US labor market remained resilient despite the continuous rate hike by Federal Reserve. With that, it could compel the Fed to increase the interest rate further as the positive job data provided more room for Fed to do so. However, the dollar index backed off from its highs after Fed’s members slashed the possibility of further rate hike in the upcoming Fed’s meeting. Early today, the President of the Federal Reserve Bank of Philadelphia Patrick T. Harker commented that they do not have to hike the cash rate at every meeting. Besides, Fed’s Philip Jefferson revealed that higher rates could exacerbate the banking stress, signaling his high unwillingness of further rate hike in the upcoming meeting. As of writing, the dollar index rose 0.06% to 104.25.

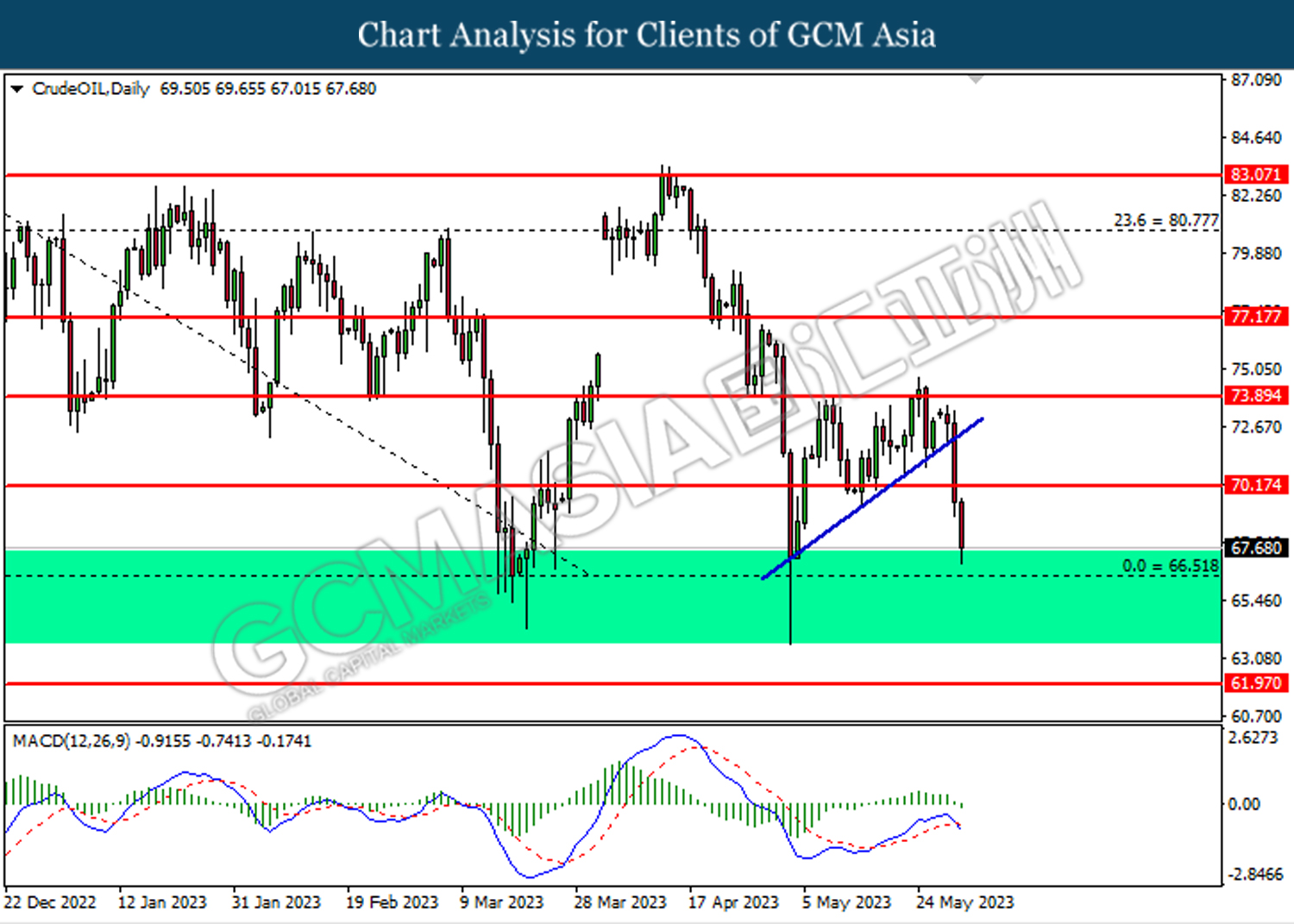

In the commodities market, crude oil prices plunged by -1.96% to $68.20 per barrel as the strengthened of US dollar and weaker-than-expected China Manufacturing PMI dampened the outlook of this black commodity product. Besides, gold prices were up by 0.20% to $1966.45 per troy ounce following the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 EUR ECB President Lagarde Speaks

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (May) | 42.9 | 42.9 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 46.9 | 46.9 | – |

| 17:00 | EUR – CPI (YoY) (May) | 7.0% | 7.0% | – |

| 20:30 | USD – ADP Nonfarm Employment Change (May) | 296K | 170K | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 235K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 47.1 | 47.0 | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -12.456M | – | – |

Technical Analysis

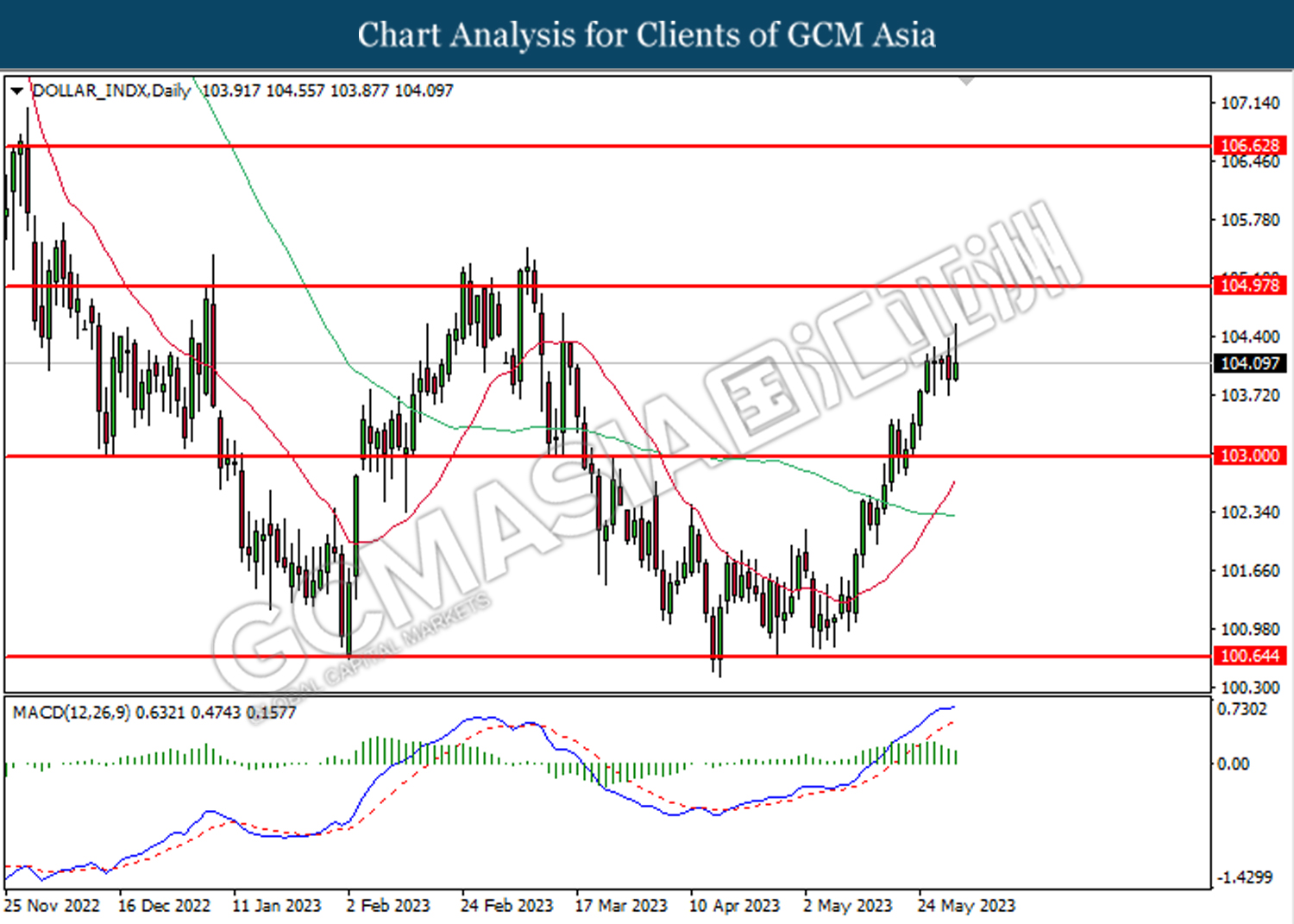

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2405, 1.2525

Support level: 1.2300, 1.2200

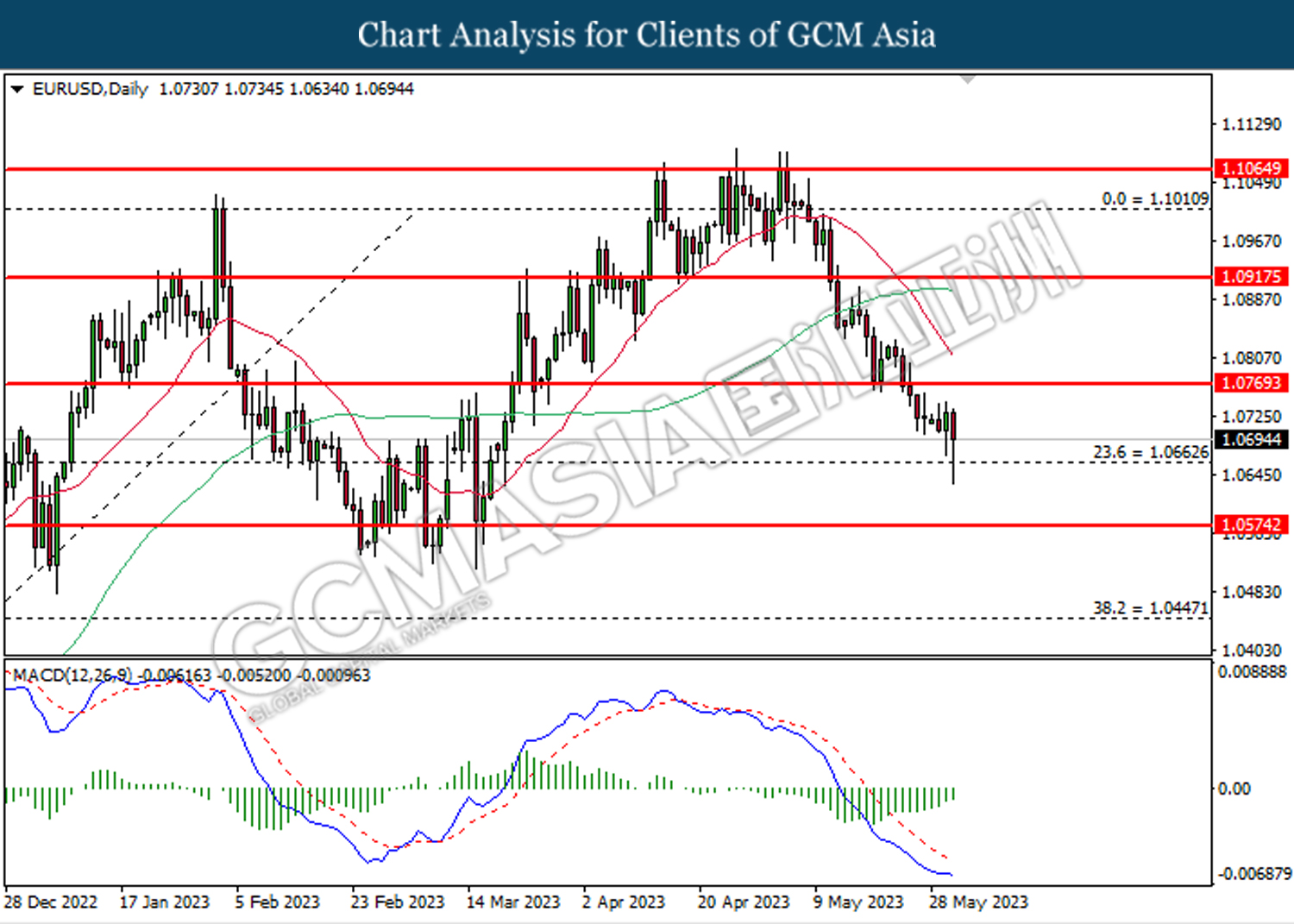

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0665. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

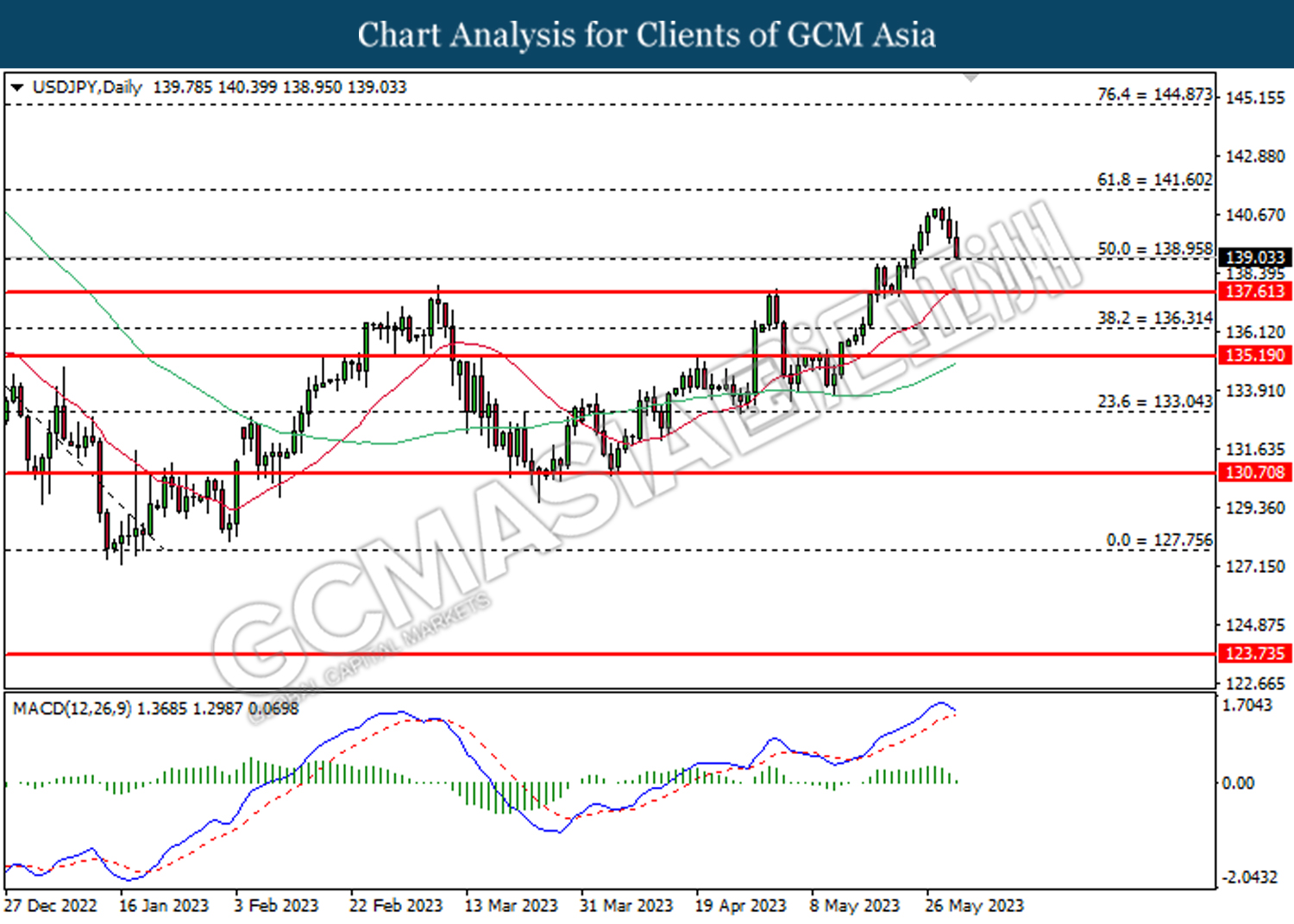

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

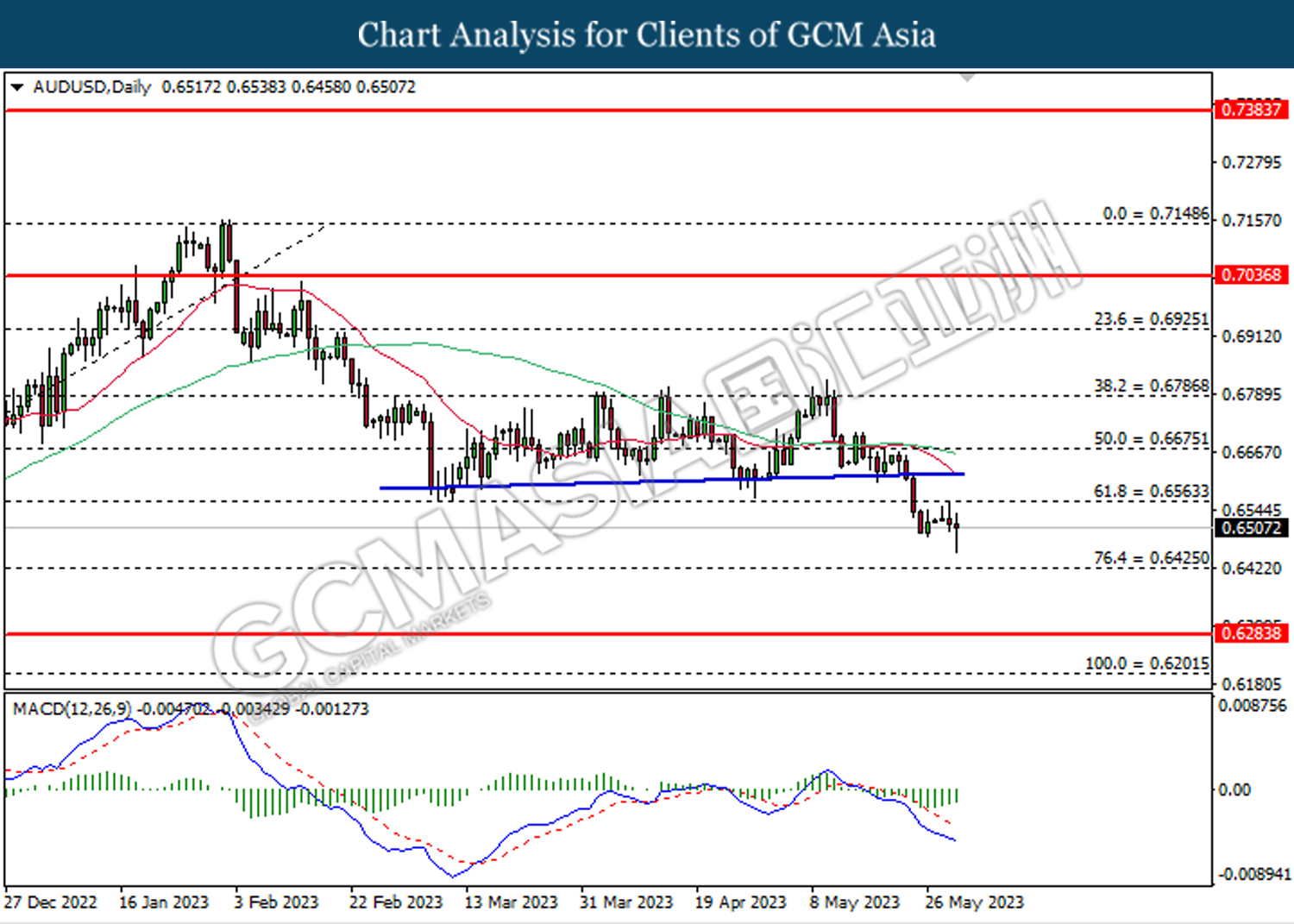

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6425.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

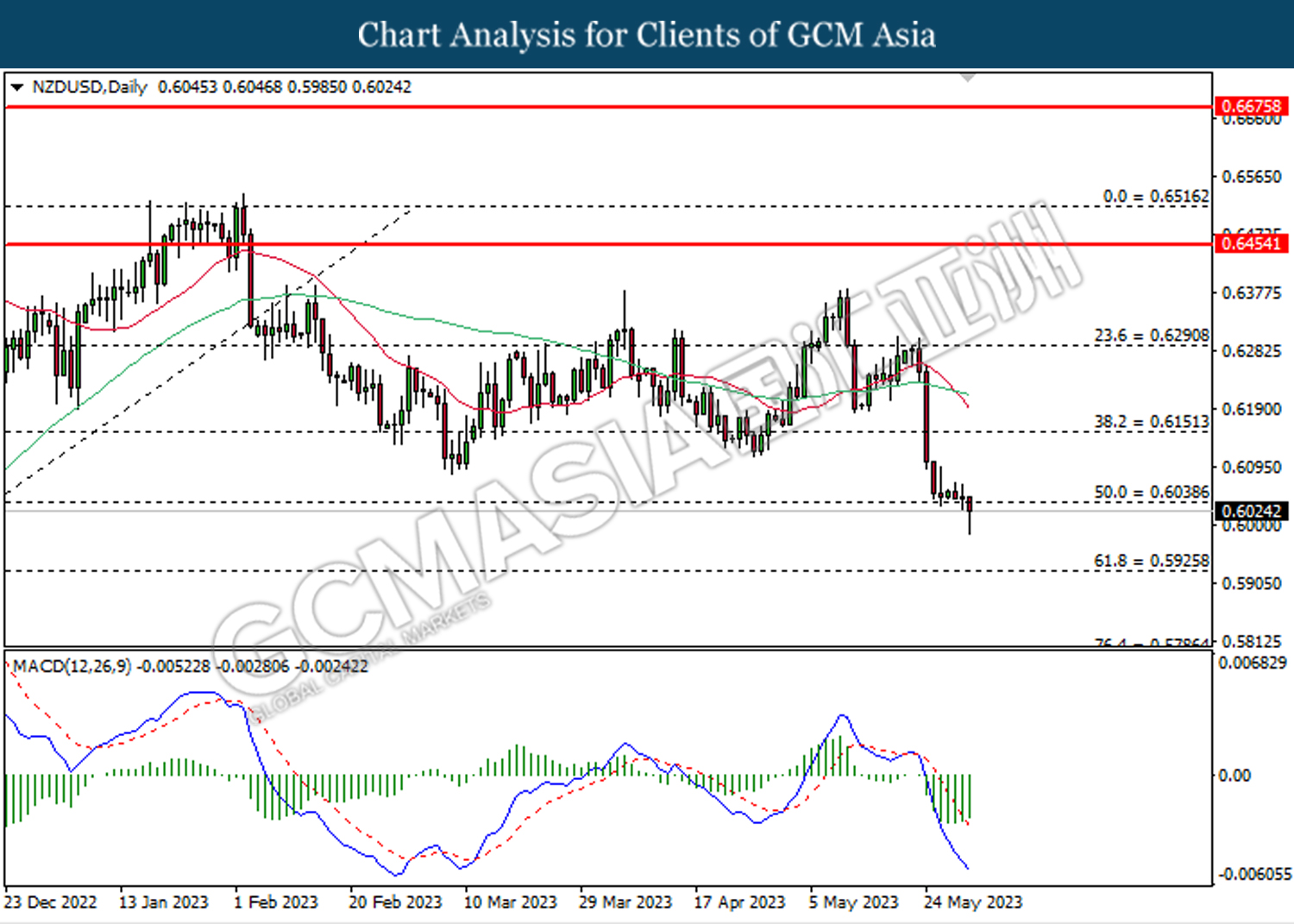

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

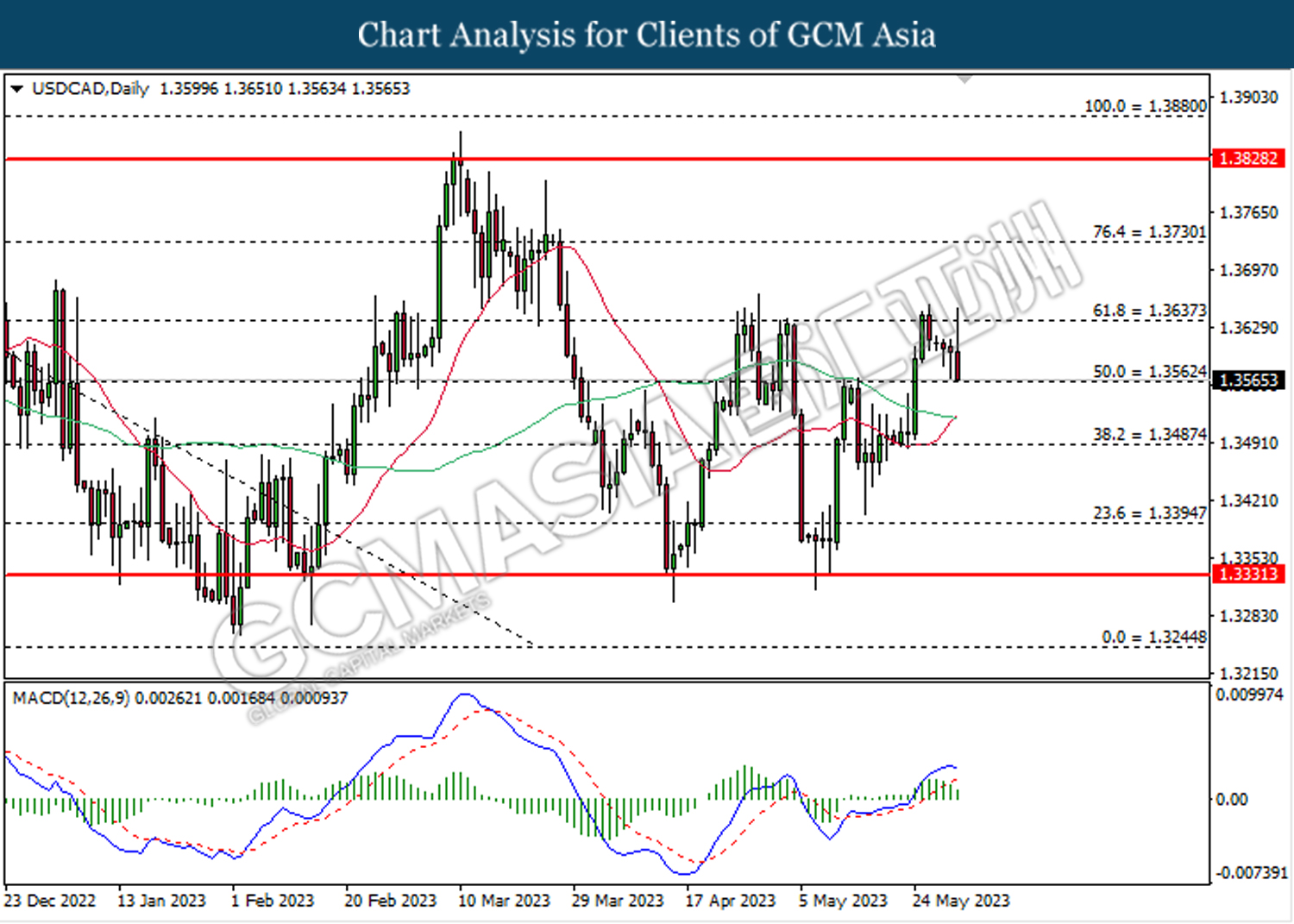

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3560. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

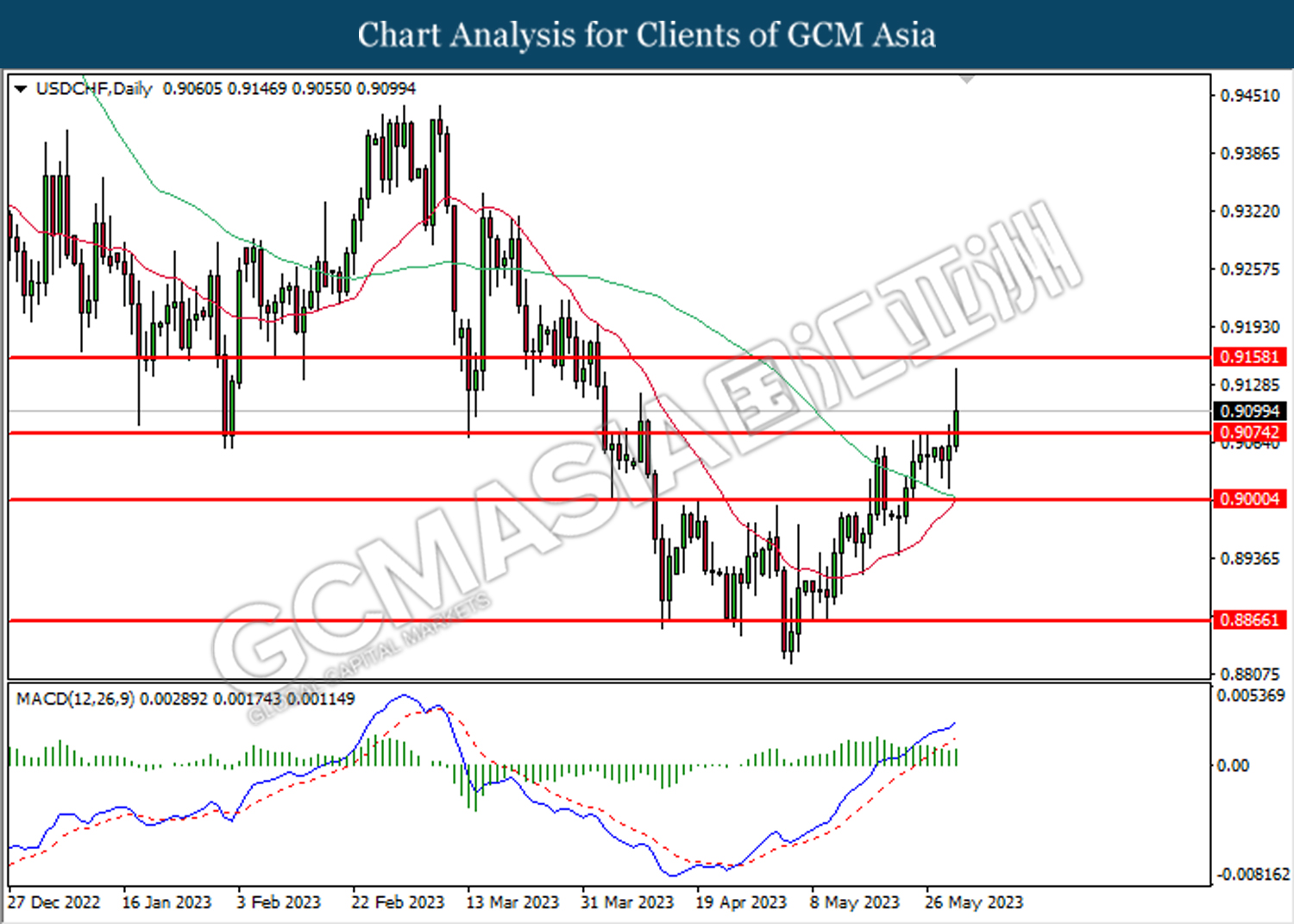

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

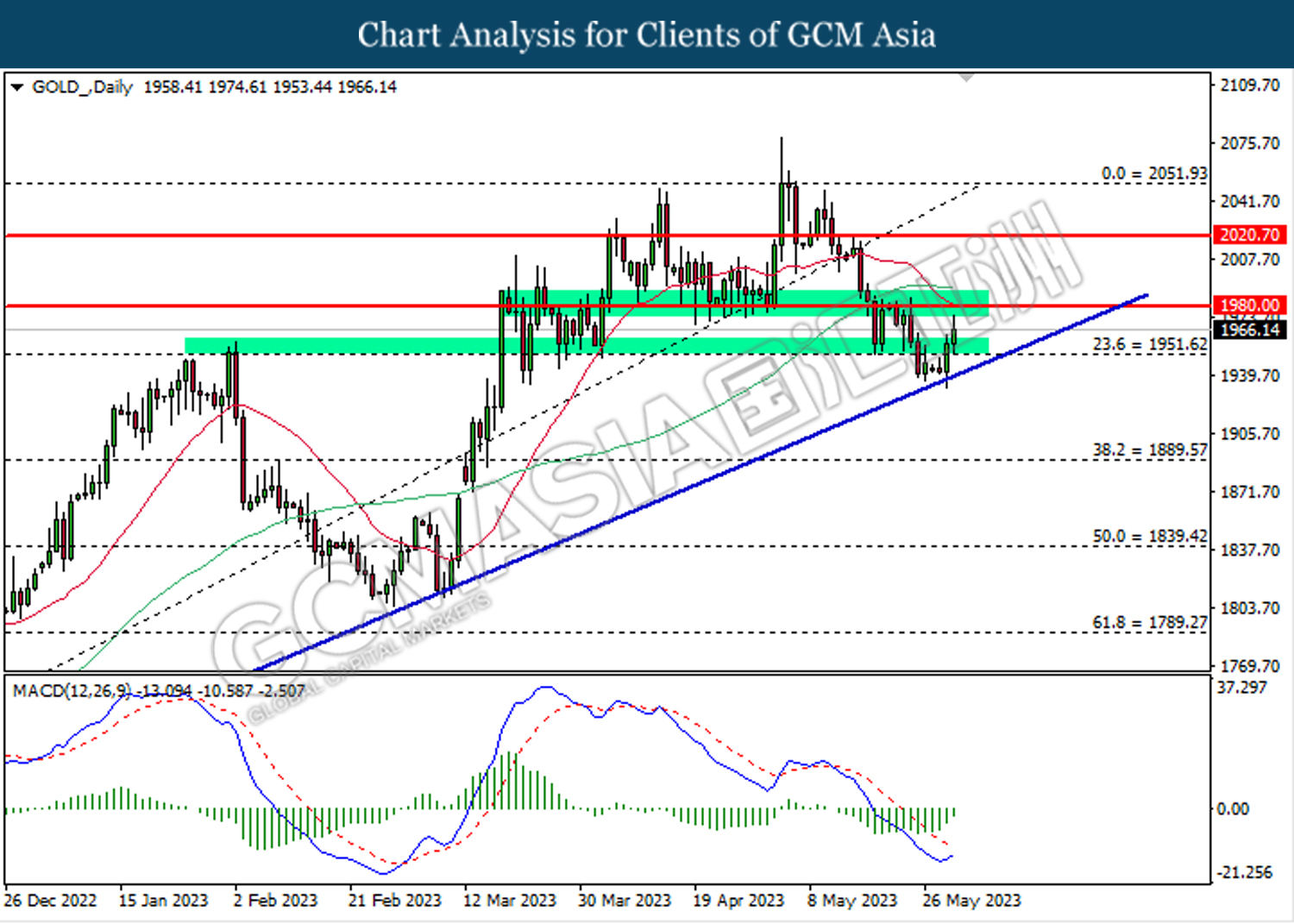

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55