1 August 2023 Afternoon Session Analysis

EUR dropped as CPI and GDP data released.

Euro (EUR), which was widely traded by global investors, dropped after Euro released CPI and GDP data. According to Eurostat, the EU CPI has decreased from 5.5% to 5.3%, matched with the market forecast. With that, it shows that the inflation in Euro zone is surely cooling down but still remain far away from the European Central Bank (ECB) target of 2%. However, there are no any firm ideas if ECB will increase or maintain its interest rate in September’s interest rate decision due to ECB members carry open minded attitude toward the interest rate decisions. Besides that, Europe GDP has increased from 0.0% to 0.3%, higher than the market forecast of 0.2%. These economic data showed that Euro consumer spending still remained at high level, although the manufacturing activities declined further last month. On the other hand, US has reported a series of outstanding economic data, such as US GDP and initial jobless claim. Initially, the market forecasted US GDP will provide a downbeat result, but it turned out a surprisingly good result, which has eventually led to a spike in dollar index. In term of the current economic condition, US economy is performing far better than Eurozone’s, dragging the currency pair EUR/USD downward. As of writing, the EUR/USD dropped -0.06% by 1.0985.

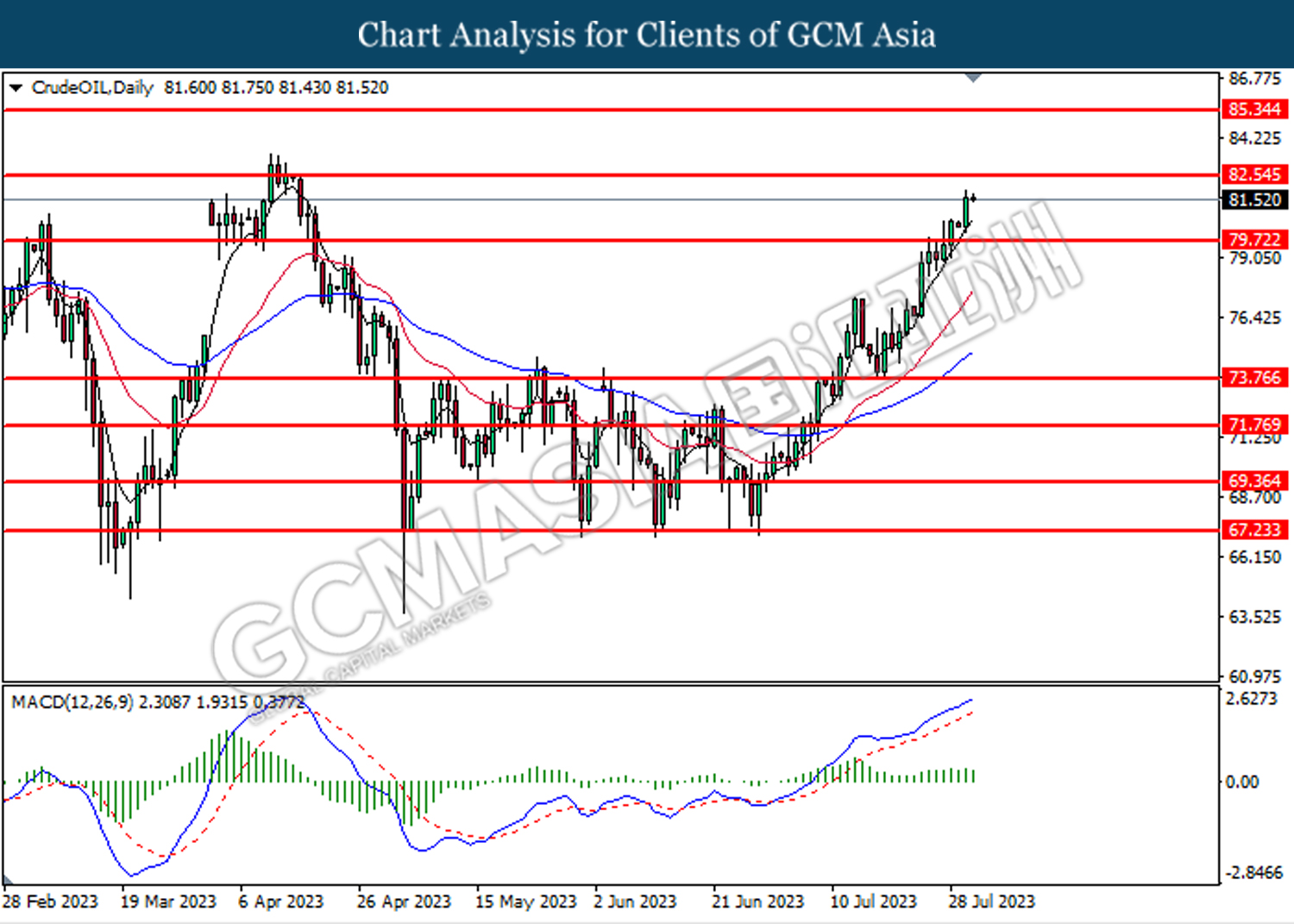

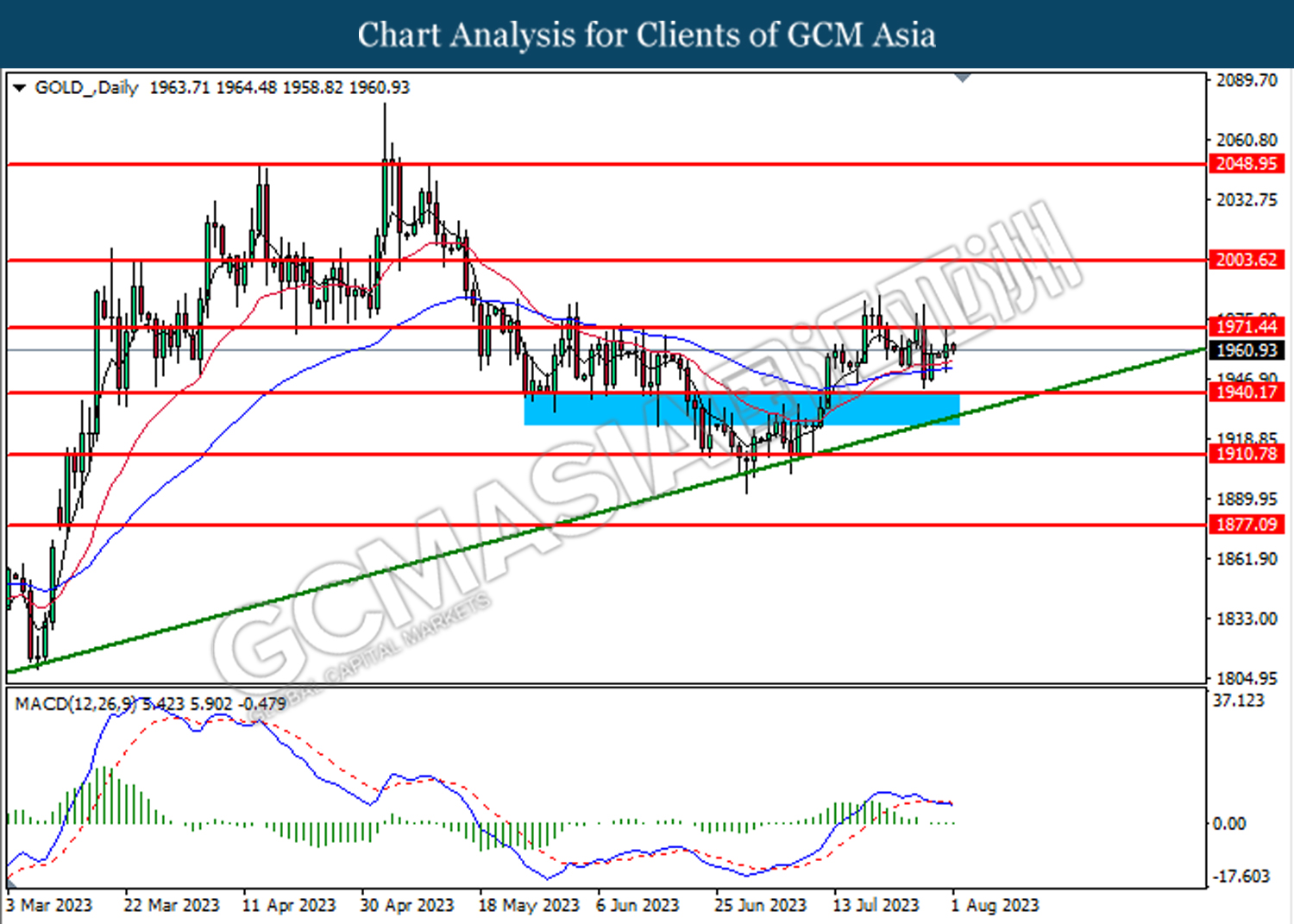

In the commodities market, crude oil prices dropped -0.12% to $81.65 per barrel as a short-term retracement following a spike caused by the better-than-expected China PMI data. Besides, gold prices dropped -0.23% to $1960.90 per troy amid the strengthening of US Dollar with the backdrop of upbeat economic data.

Today’s Holiday Market Close

Time Market Event

All Day CHF National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 15:55 | EUR – HCOB Germany Manufacturing PMI (Jul) | 40.6 | 38.8 | – |

| 16:30 | GBP – S&P Global/CIPS UK Manufacturing PMI (Jul) | 46.5 | 45.0 | – |

| 16:30 | CrudeOIL – API Weekly Crude Oil Stock | 1.319M | – | – |

| 17:00 | EUR – Unemployment Rate (Jun) | 6.5% | 6.5% | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 46.0 | 46.5 | – |

| 22:00 | USD – JOLTs Job Openings (Jun) | 9.824M | 9.620M | – |

Technical Analysis

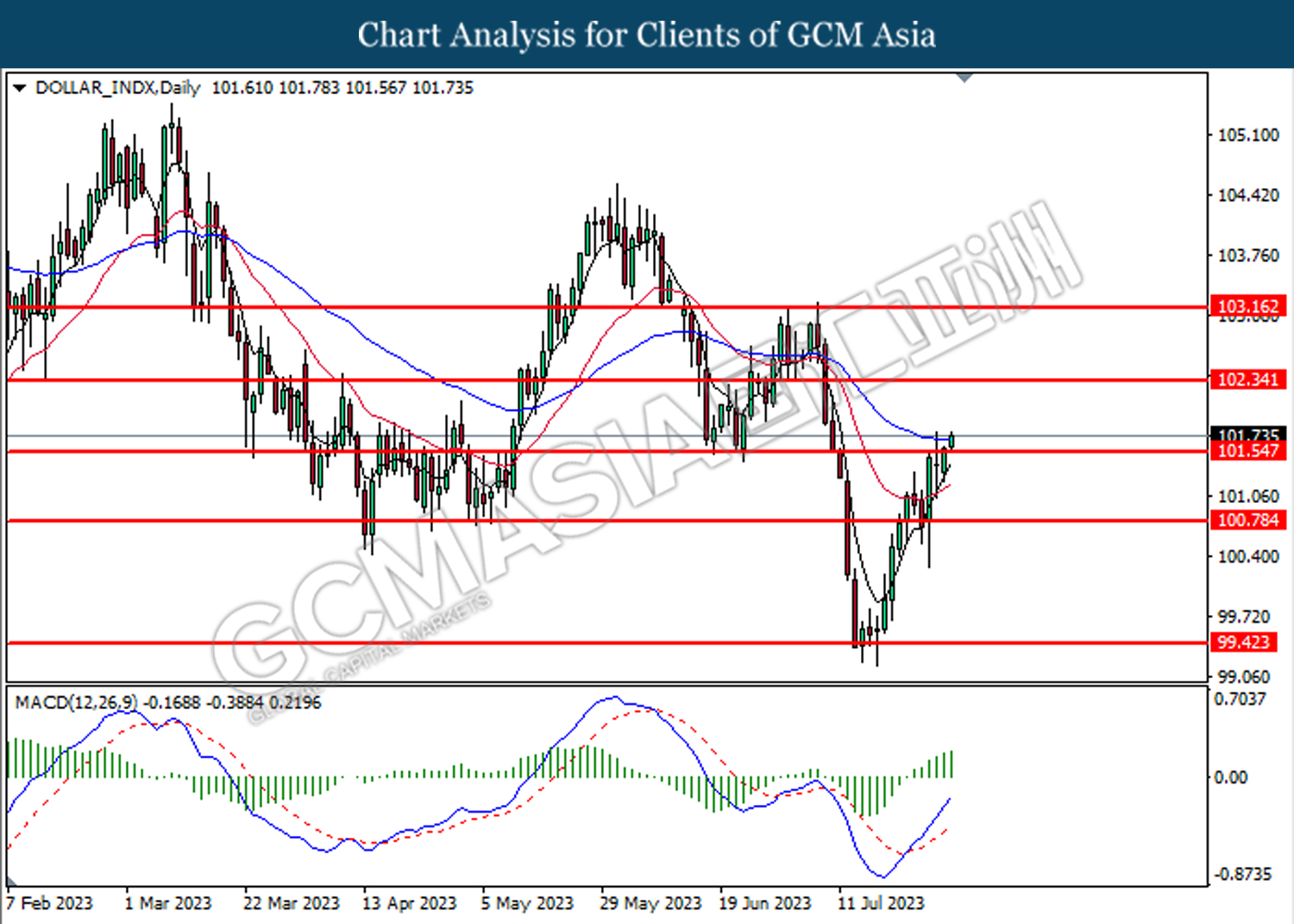

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.55. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level at 102.35.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

GBPUSD, Daily: GBPUSD was traded lower while testing the support level at 1.2827. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2827, 1.3000

Support level: 1.2670, 1.2525

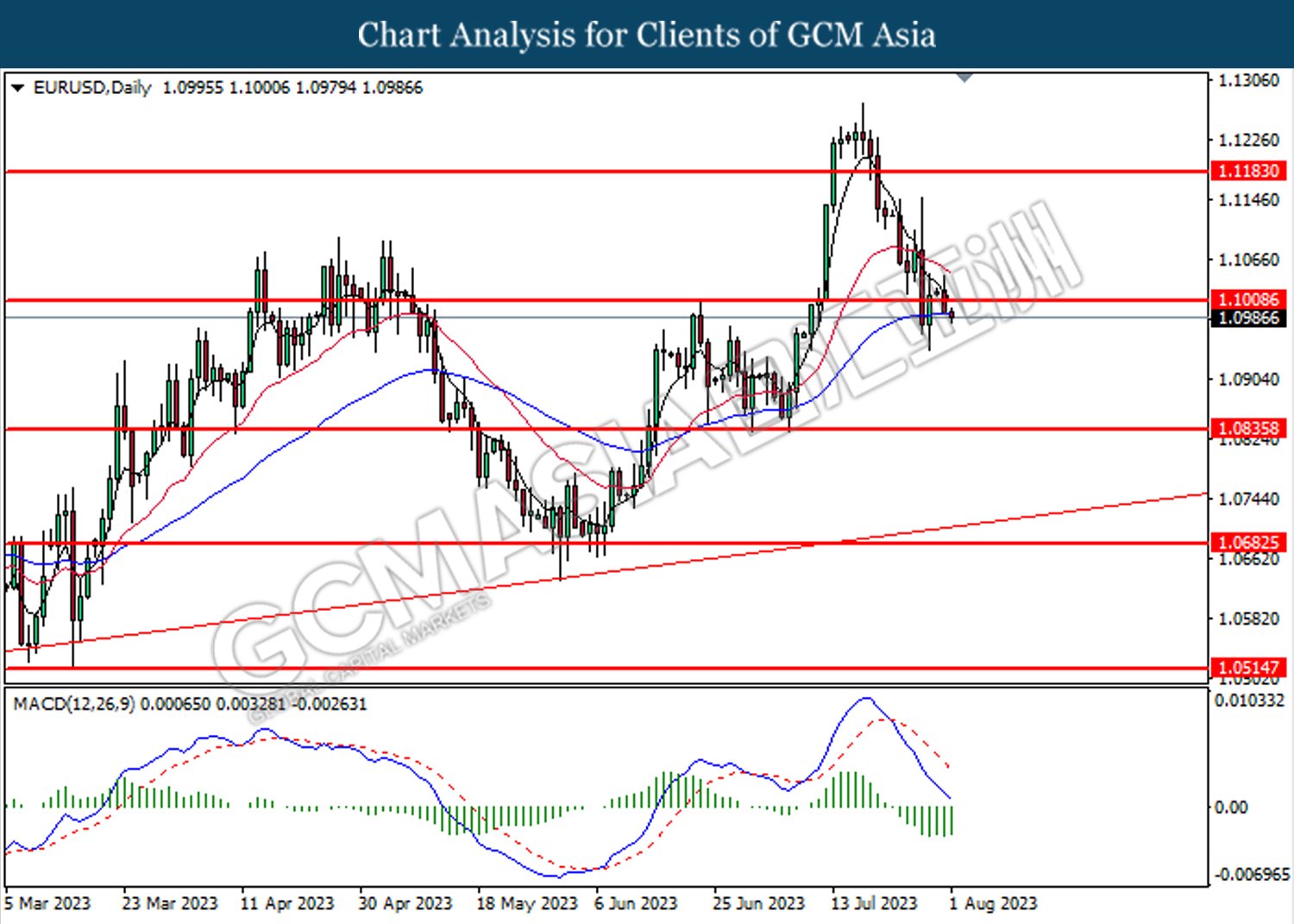

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

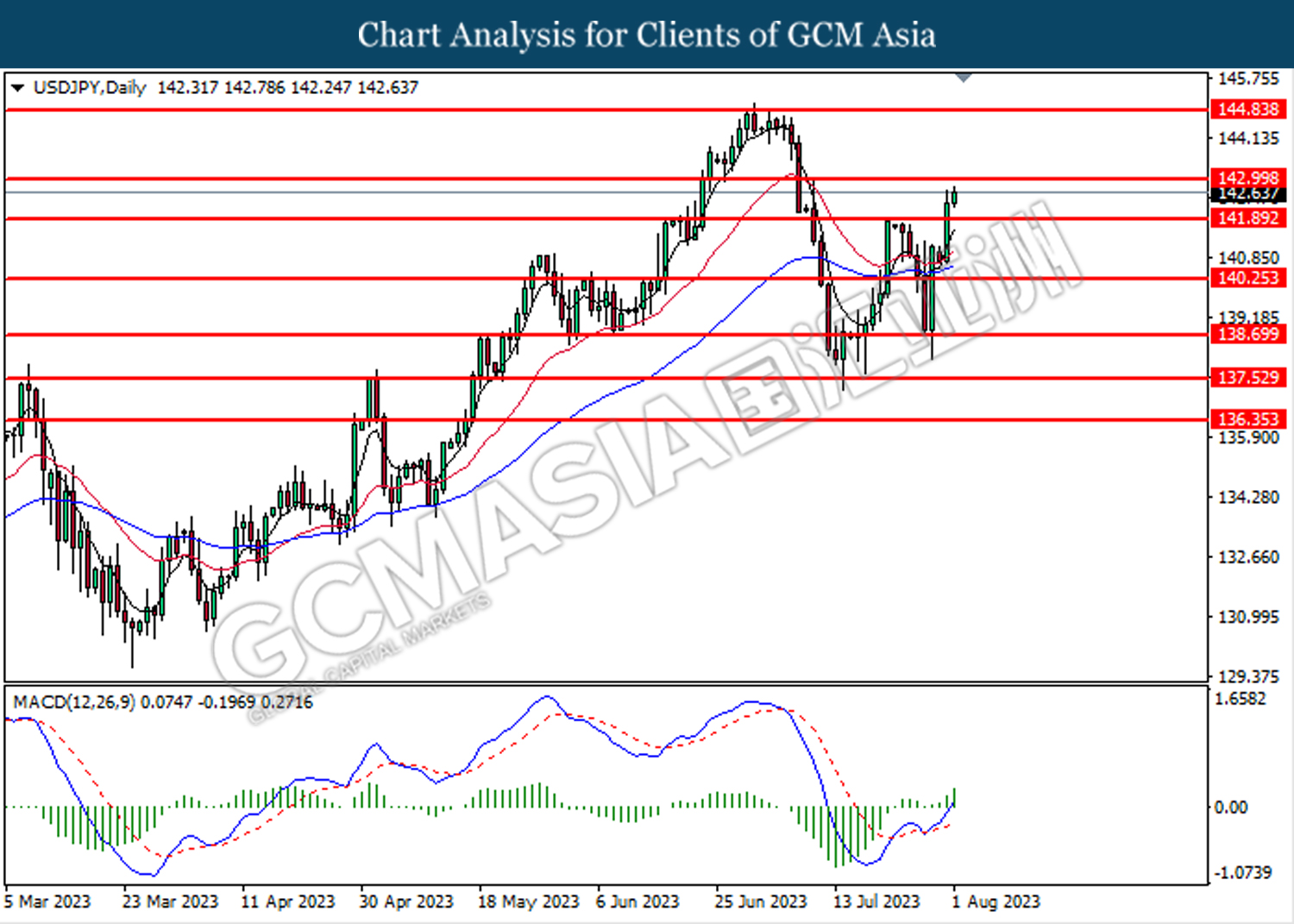

USDJPY, Daily: USDJPY was traded higher following the prior after breakout above the previous resistance level at 141.90. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 143.00.

Resistance level: 141.90, 143.00

Support level: 140.25, 138.70

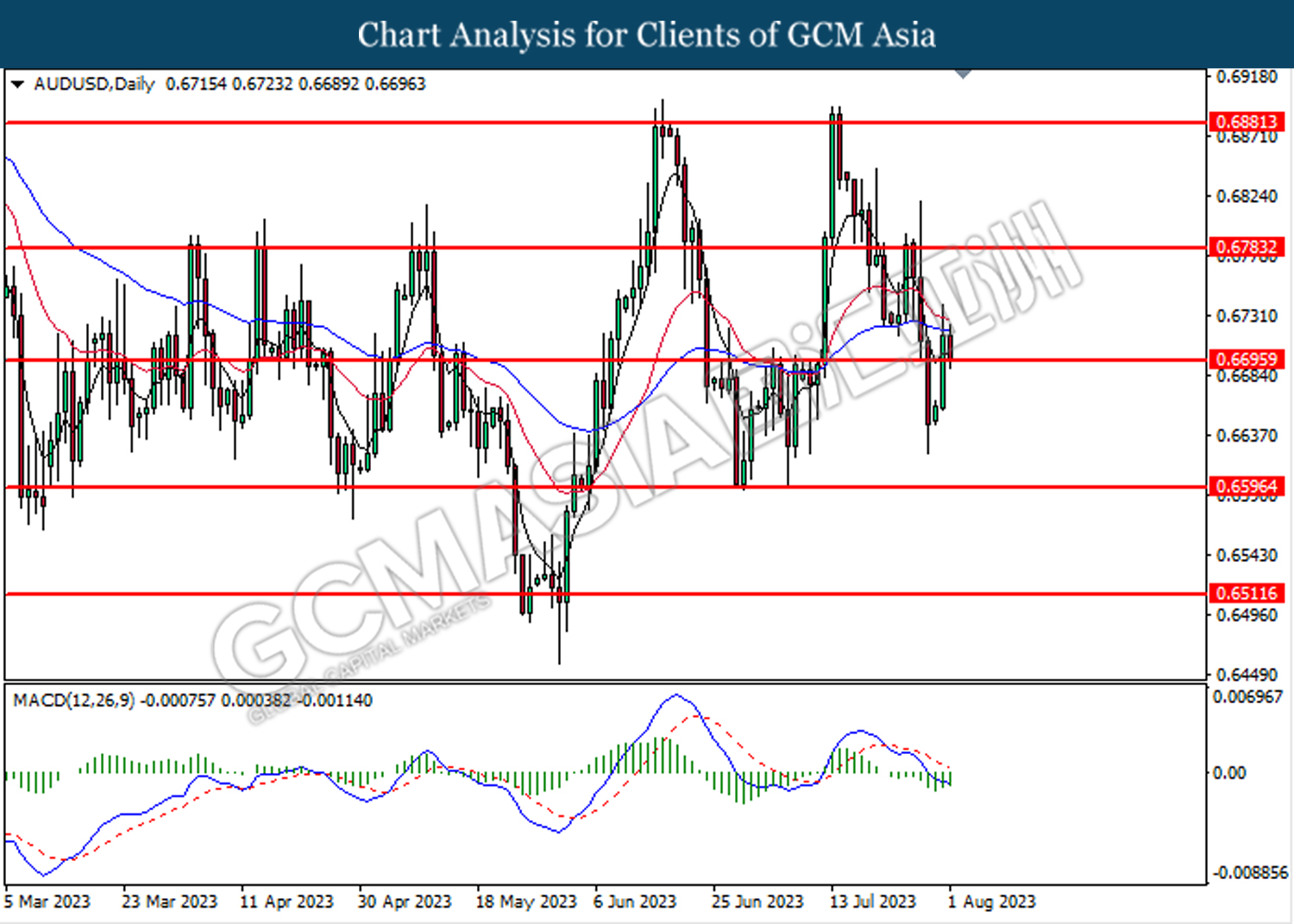

AUDUSD, Daily: AUDUSD was traded lower while testing the support level at 0.6695. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6785, 0.6880

Support level: 0.6695, 0.6595

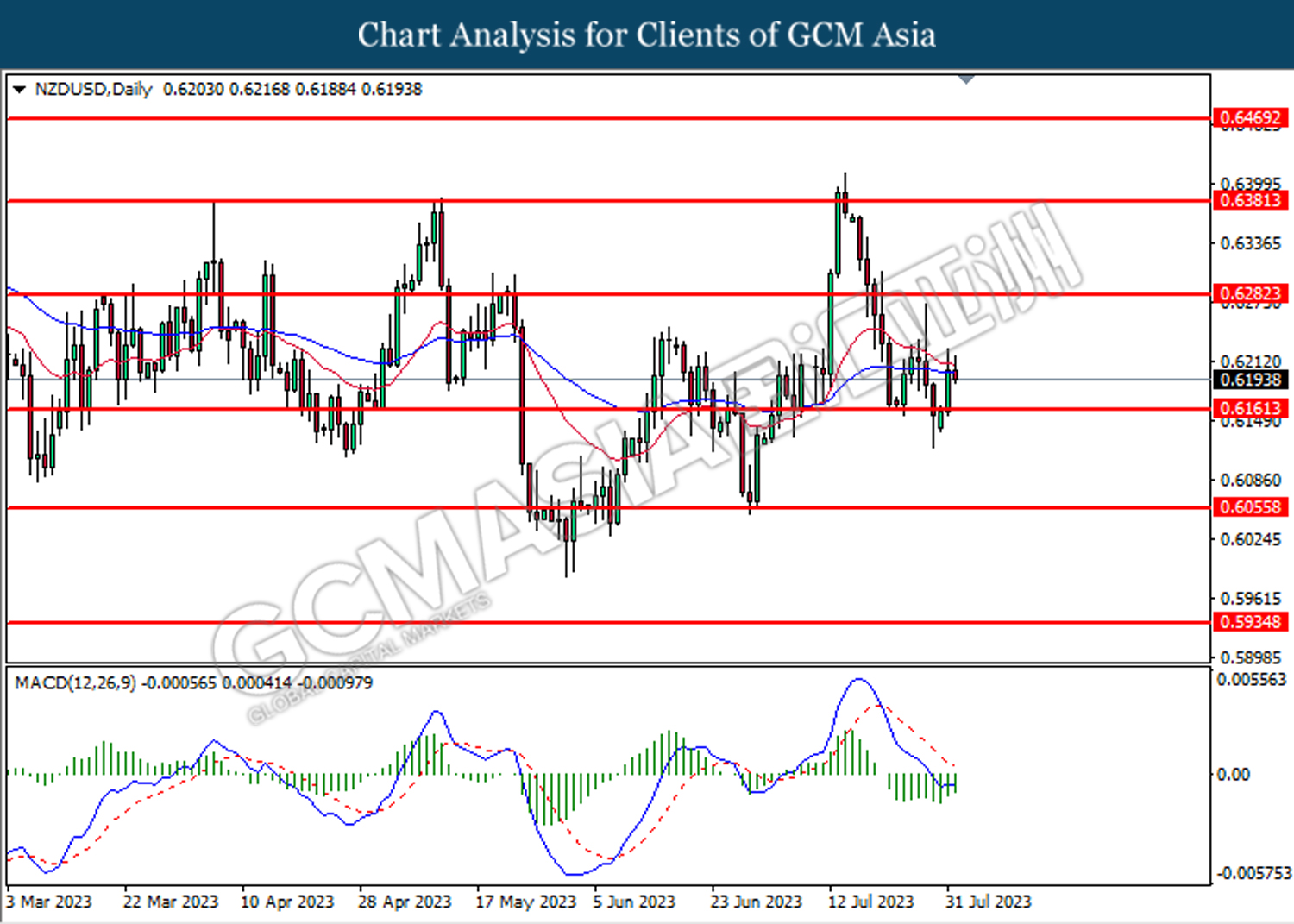

NZDUSD, Daily: NZDUSD was traded higher following the prior after breakout the previous resistance level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6280

Resistance level: 0.6280, 0.6380

Support level: 0.6160, 0.6055

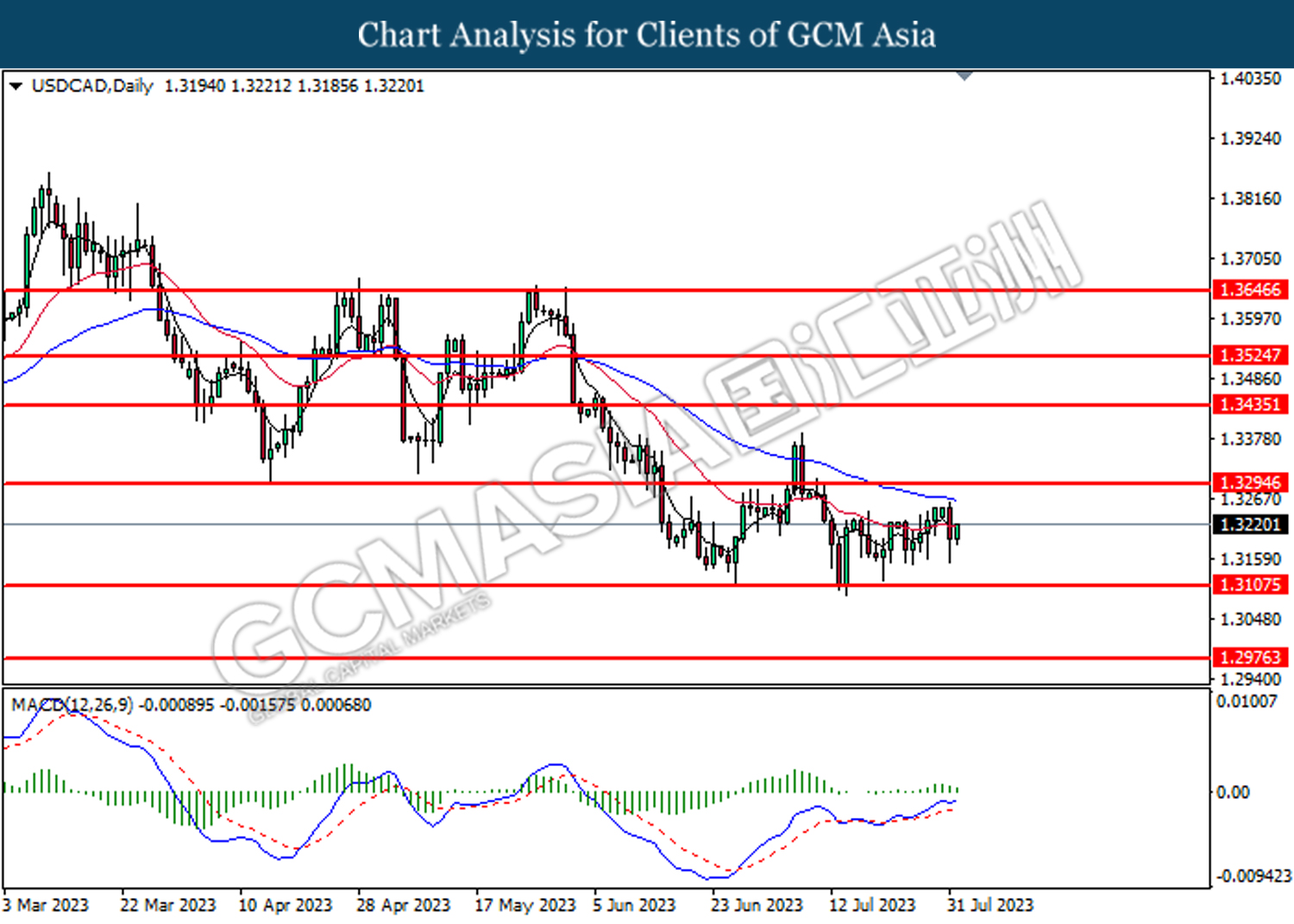

USDCAD, Daily: USDCAD was traded flat above the support level at 1.3110. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 1.3110.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

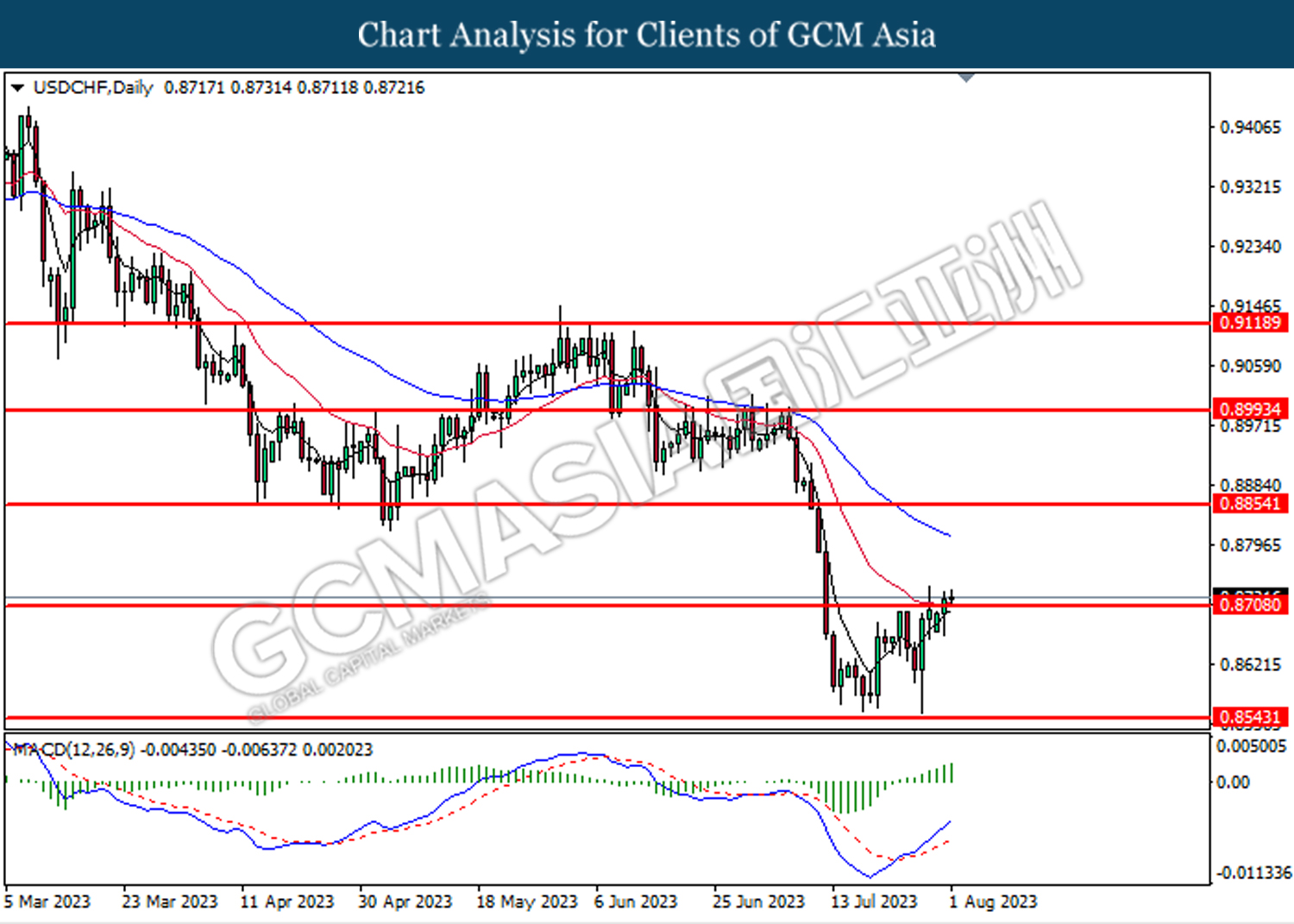

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.8855

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

CrudeOIL, Daily: Crude oil price was traded higher following the prior after breakout above the previous resistance level at 79.70. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 85.35.

Resistance level: 82.50, 85.35

Support level: 79.70, 77.25

GOLD_, Daily: Gold price was traded flat above the support level at 1940.20. MACD are lack of signal due to the momentum are weak, recommend wait for the signal appear only entry the market.

Resistance level: 1971.45, 2003.60

Support level: 1940.20, 1910.80