1 August 2023 Morning Session Analysis

US dollar flat as traders await for more economic data.

The dollar index, which was traded against a basket of six major currencies, hovered near the recent high as the market participants were waiting for a series of economic data before taking a move. Looking ahead, among all the important economic data, the upcoming non-farm payrolls report on Friday will play a crucial role in shaping the Federal Reserve’s interest rate decision in late September. The data from the U.S. will determine whether the economy continues to display resilience. If it does, this could provide support to the dollar, at least allowing it to maintain its current position. Besides, the dollar managed to hold its ground as a Fed’s survey revealed that U.S. banks reported implementing stricter credit standards and experiencing reduced loan demand in the second quarter. This indicates that the increasing interest rates are impacting the economy. The survey, known as the Senior Loan Officer Opinion Survey (SLOOS), covers both businesses and consumers, and it further indicated that banks anticipate tightening their lending standards throughout the remainder of 2023. In a higher interest rate environment, it is expected to observe a tightening of lending standards and a decrease in loan demand. As a result, the market risk averse sentiment heightened, urging the safe haven currency, such as US dollar, spiked up early today. As of writing, the dollar index edged up by 0.24% to 101.85.

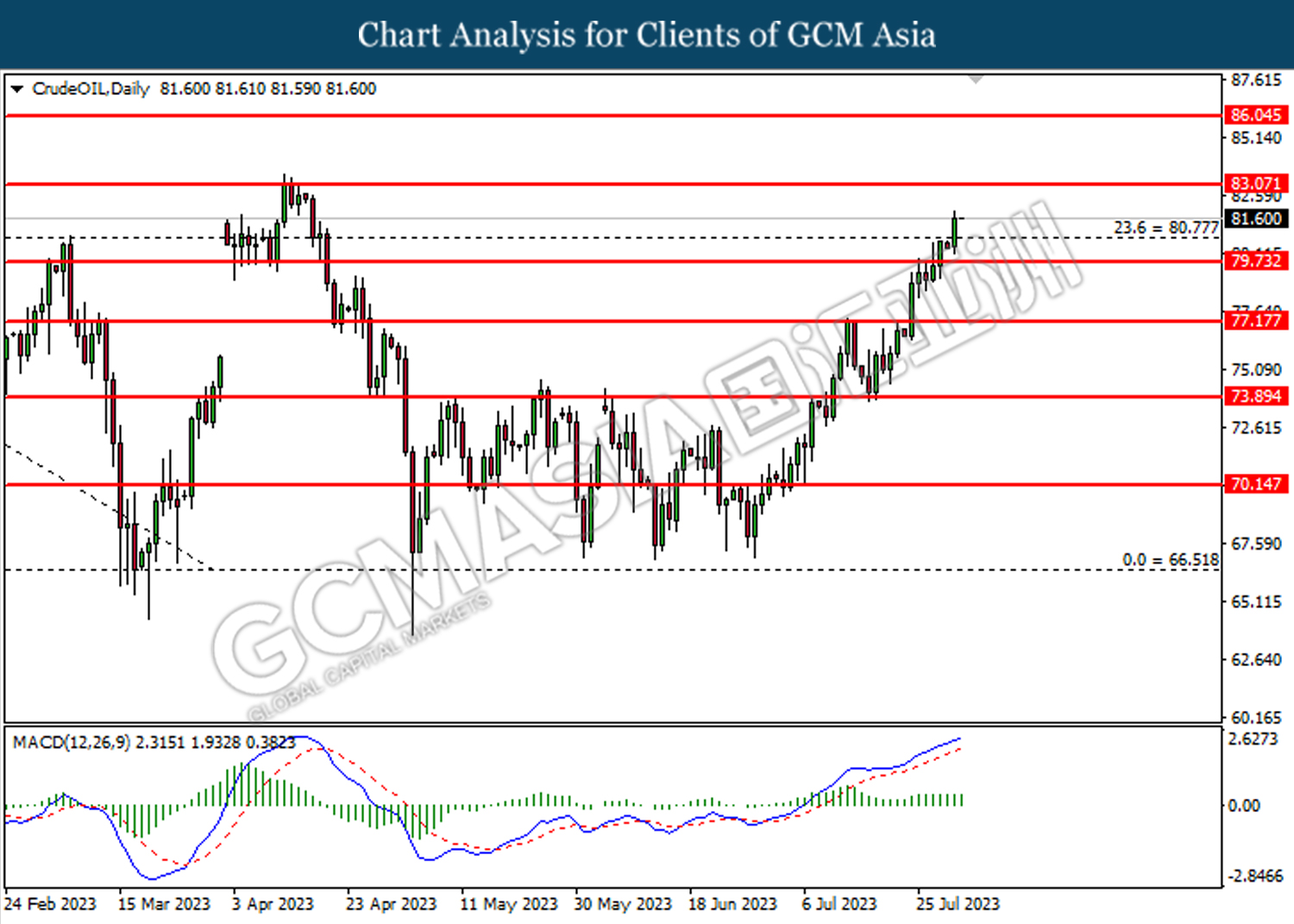

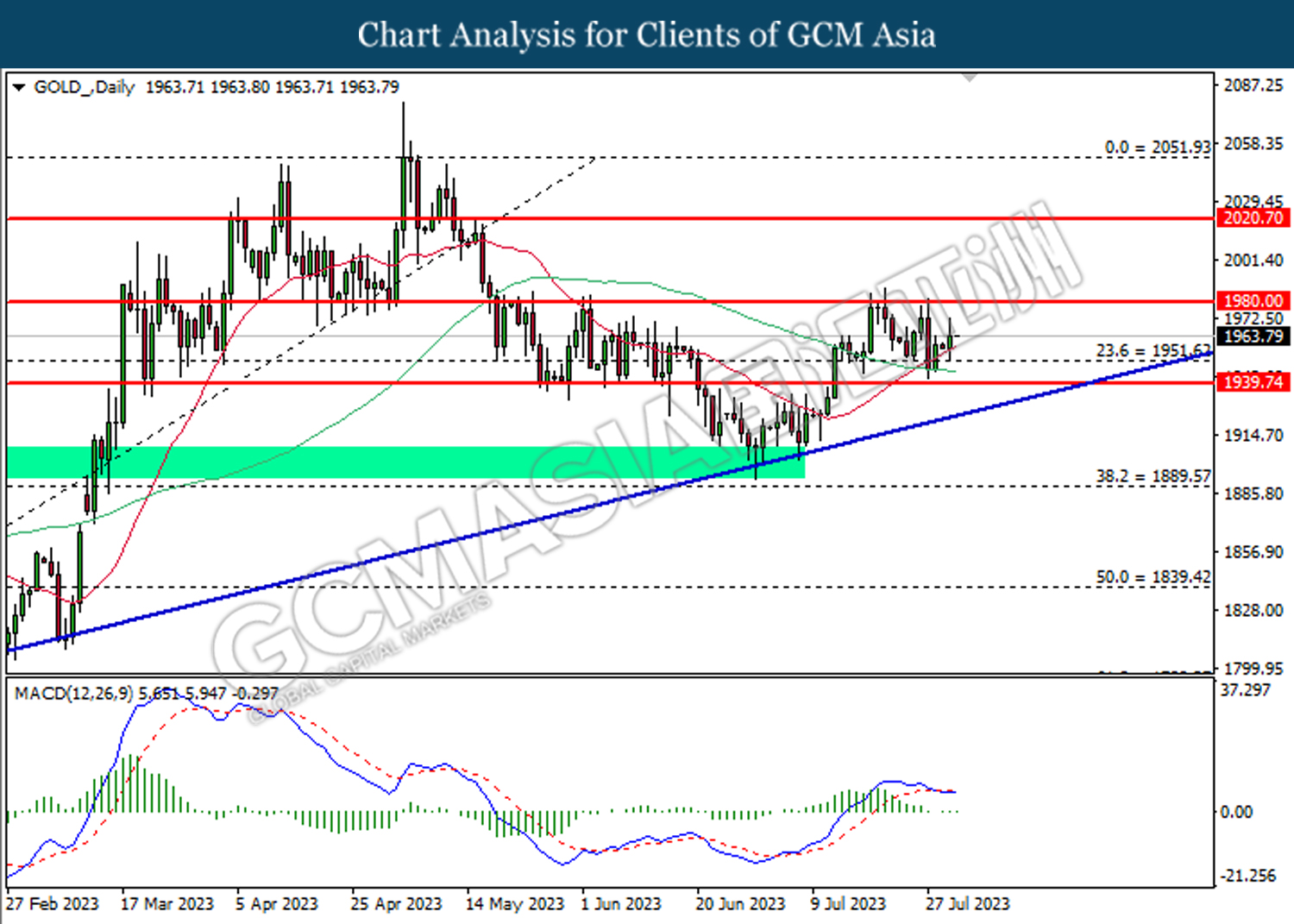

In the commodities market, crude oil prices were up by 1.14% to $81.65 per barrel, supported by the factor of tightening global supply and rising demand, especially from China. Besides, gold prices ticked down by -0.06% to $1964.35 per troy ounce as dollar strengthened further.

Today’s Holiday Market Close

Time Market Event

All Day CHF National Day

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Aug) | 4.10% | 4.35% | – |

| 15:55 | EUR – HCOB Germany Manufacturing PMI (Jul) | 40.6 | 38.8 | – |

| 16:30 | GBP – S&P Global/CIPS UK Manufacturing PMI (Jul) | 46.5 | 45.0 | – |

| 16:30 | CrudeOIL – API Weekly Crude Oil Stock | 1.319M | – | – |

| 17:00 | EUR – Unemployment Rate (Jun) | 6.5% | 6.5% | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 46.0 | 46.5 | – |

| 22:00 | USD – JOLTs Job Openings (Jun) | 9.824M | 9.620M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

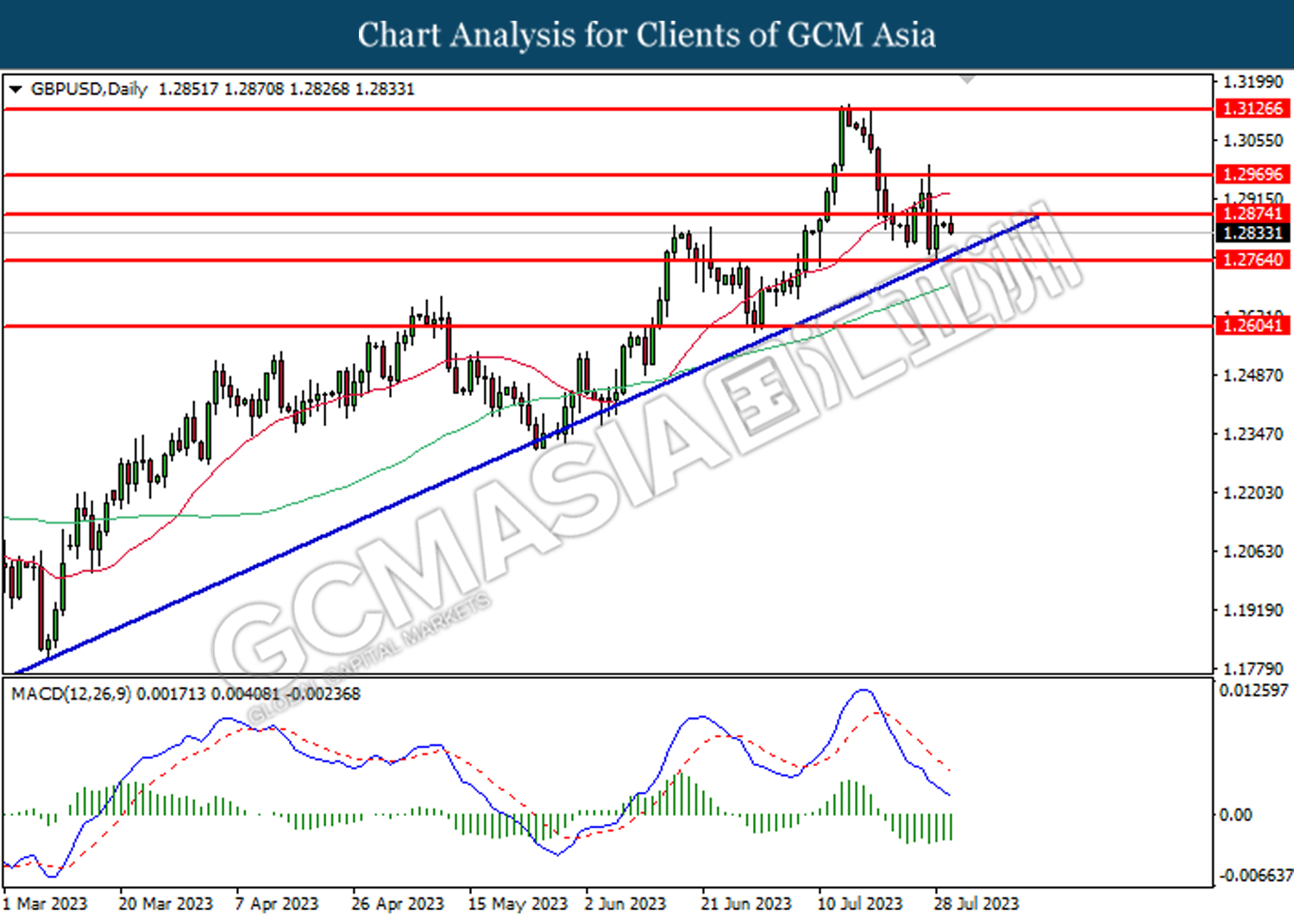

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2875. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

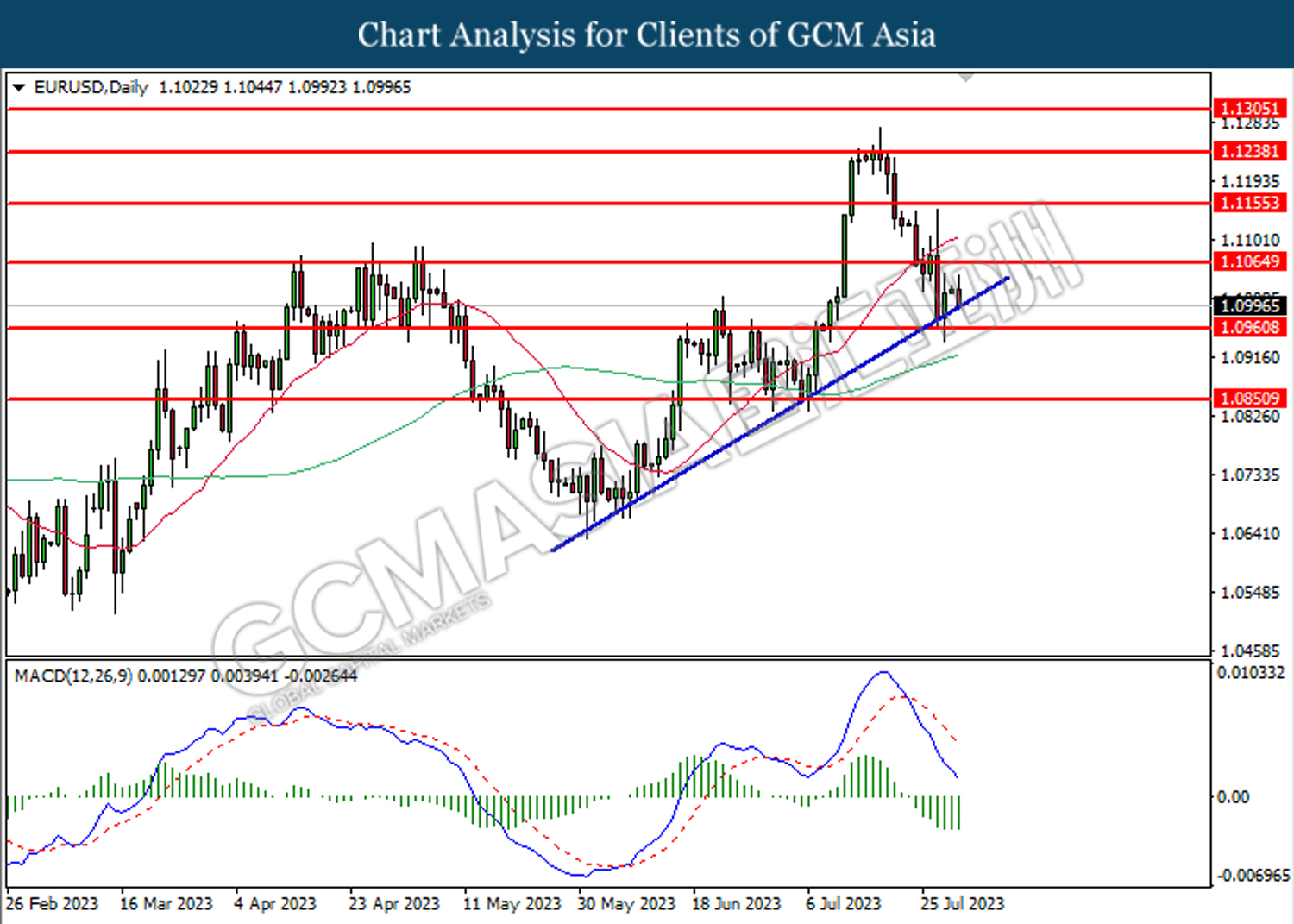

EURUSD, Daily: was traded lower while currently retesting the upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

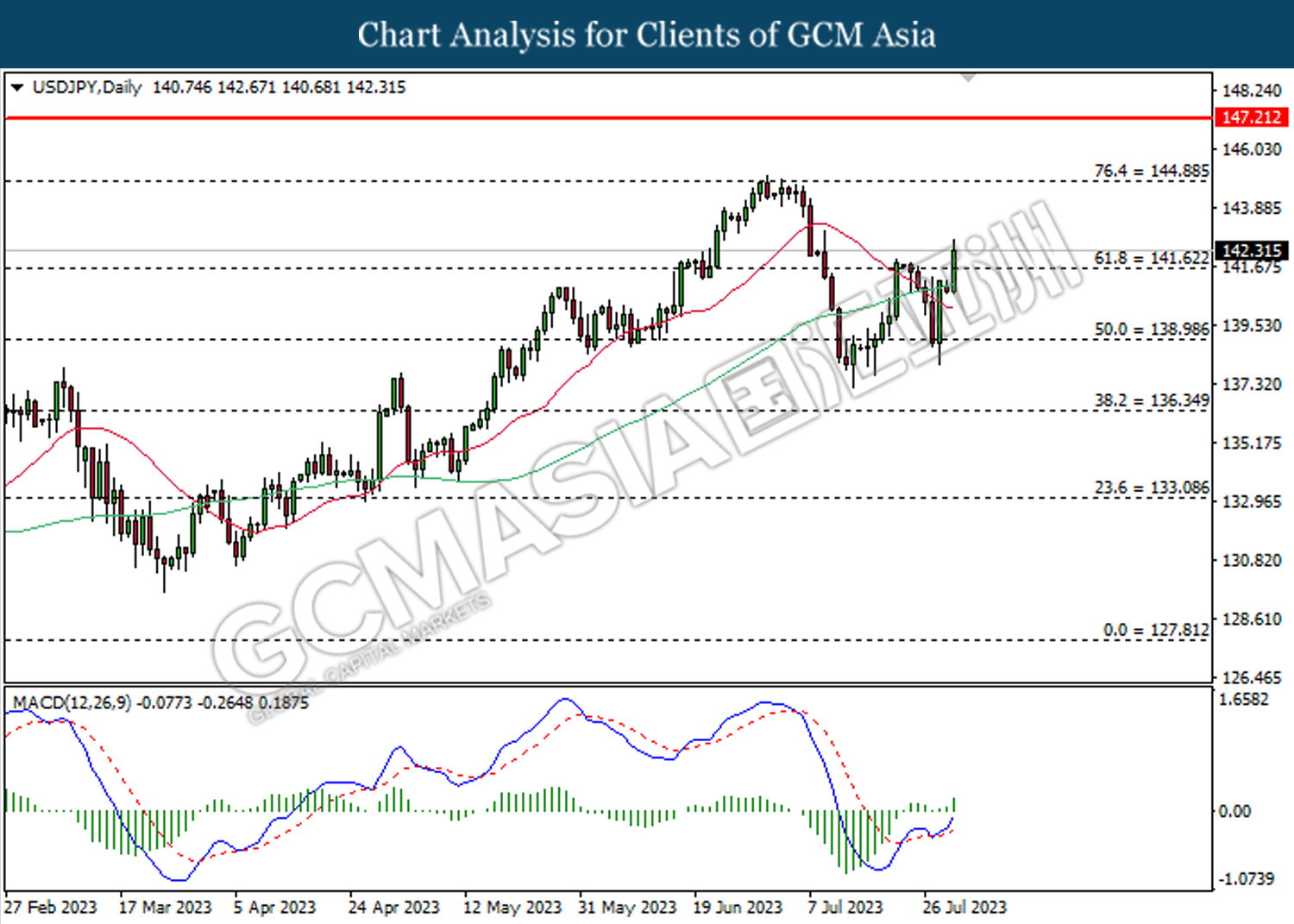

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 141.60.

Resistance level: 141.60, 144.90

Support level: 139.00, 136.35

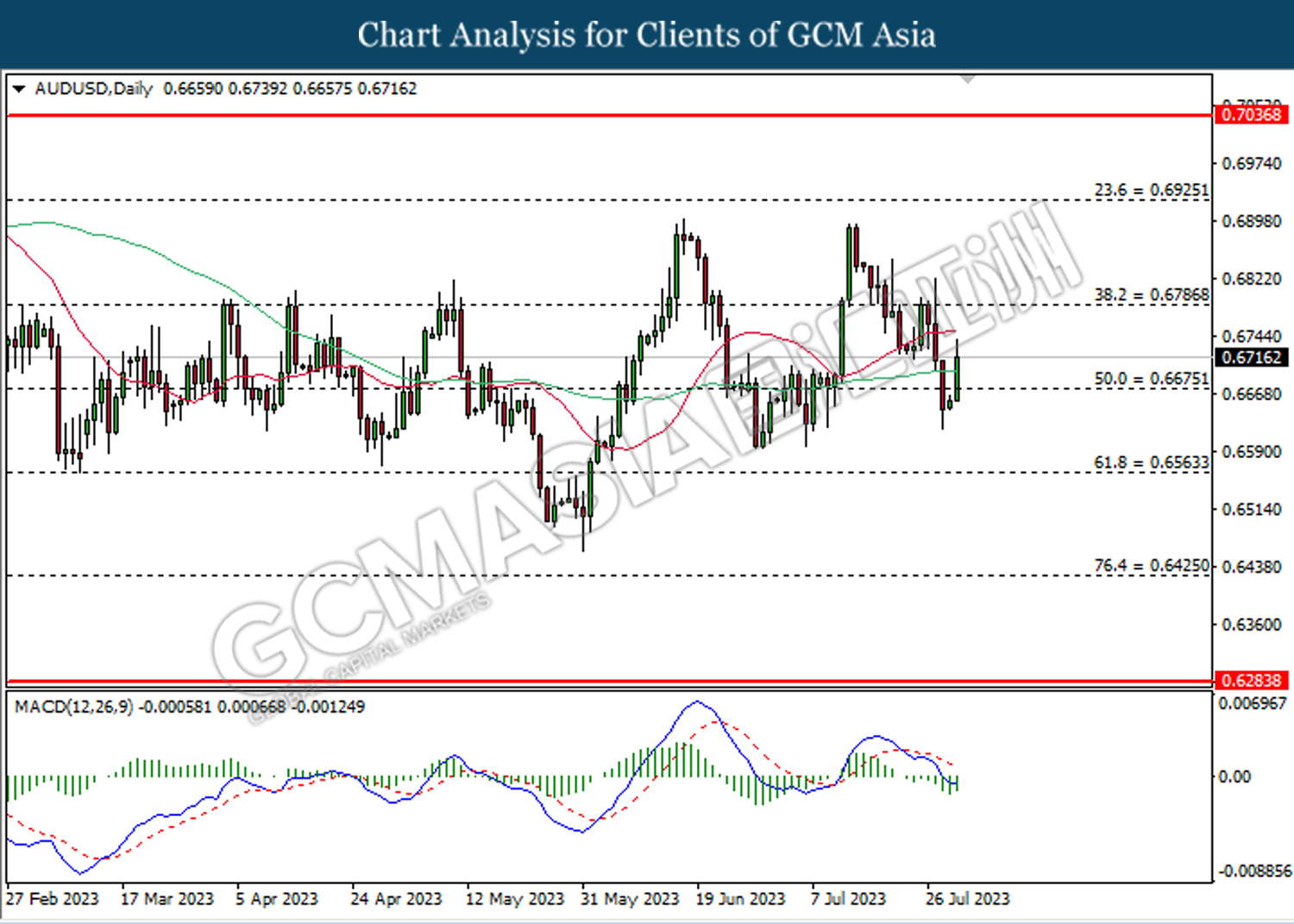

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

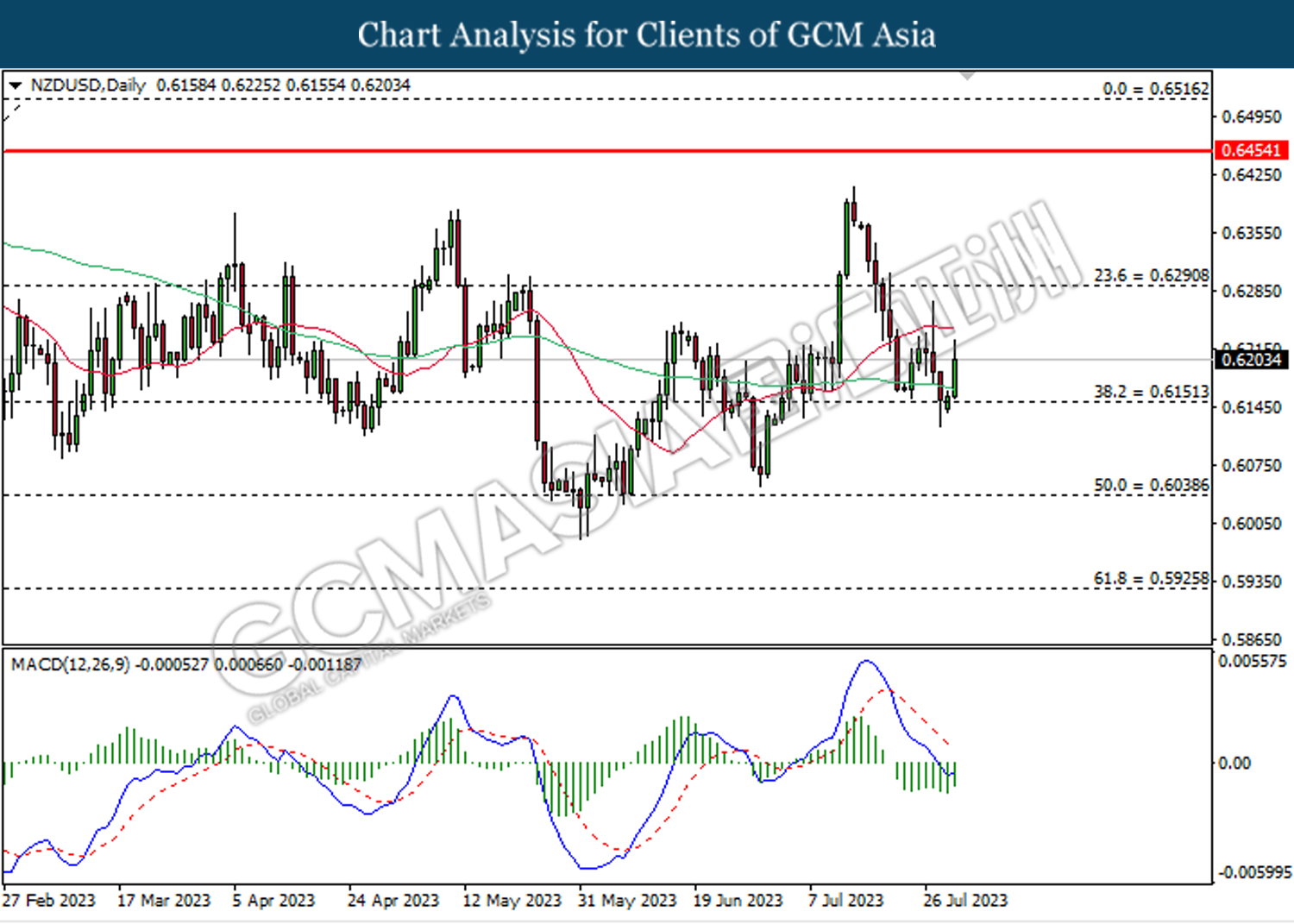

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3175. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 83.05.

Resistance level: 83.05, 86.05

Support level: 80.75, 79.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1951.60. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75