01 September 2020 Afternoon Session Analysis

Aussie surged amid upbeat data.

The Australian Dollar surged over the backdrop of the string of upbeat economic data from the Australia and China region in the early morning. According to Australian Bureau of Statistics, the Australia Current Account had improved significantly from the previous reading of 8.4B to 17.7B, much better than the market forecast at 13.0B, which indicating that the export value from the Australia remained strong even though the coronavirus pandemics still persisted. Besides that, the Markit reported that the China Caixin Manufacturing Purchasing Managers Index (PMI) notched up from the preliminary reading of 52.8 to 53.1, which confounding market forecast for a reading of up to 52.6, which spurring positive prospect for the Chinese’s proxy currency Australian Dollar. In addition, the Australian central bank decided to maintain the targets for its interest rate at 0.25%, while reiterated that they will continue to eye on global growth risk, more stimulus can be anticipated if the course of events urge their economy growth goes against their expectation. As of writing, AUD/USD appreciated by 0.30% to 0.7396.

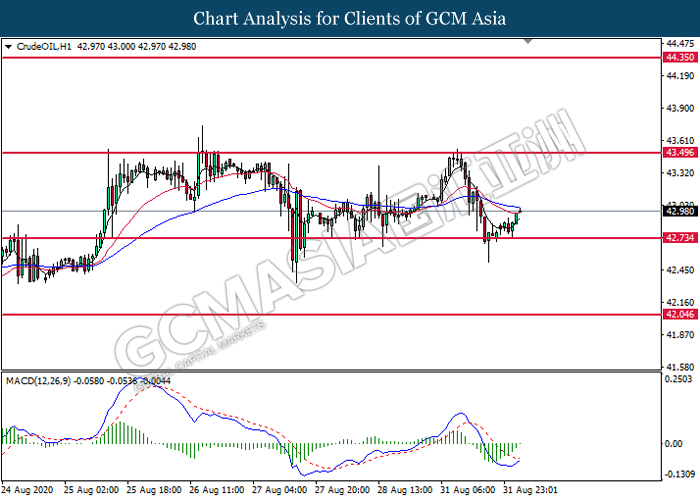

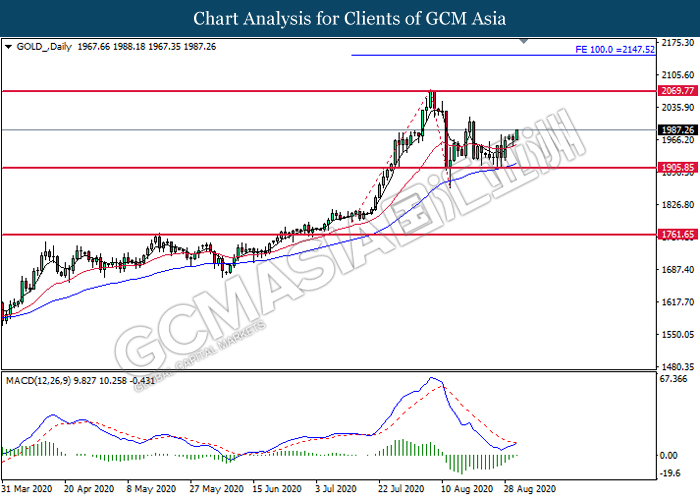

In the commodities market, the crude oil price surged 0.38% to $42.88 per barrel as of writing. The oil market edged higher amid the crude oil supply from the U.S. Gulf of Mexico remained down 70%, or 1.29 million barrels per day, according to data released on Sunday by the Department of Interior. On the other hand, the gold price appreciated by 0.85% to $1985.10 per troy ounces as of writing amid investors still digesting the dovish statement from the U.S. Federal Reserve Chairman Jerome Powell’s last week.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.55 | EUR – German Manufacturing PMI (Aug) | 53.0 | 53.0 | – |

| 15.55 | EUR – German Unemployment Change (Aug) | -18K | 1K | – |

| 16.30 | GBP – Manufacturing PMI (Aug) | 55.3 | 55.3 | – |

| 17.00 | EUR – CPI (YoY) (Aug) | 0.4% | 0.2% | – |

| 22.00 | USD – ISM Manufacturing PMI (Aug) | 54.2 | 54.5 |

Technical Analysis

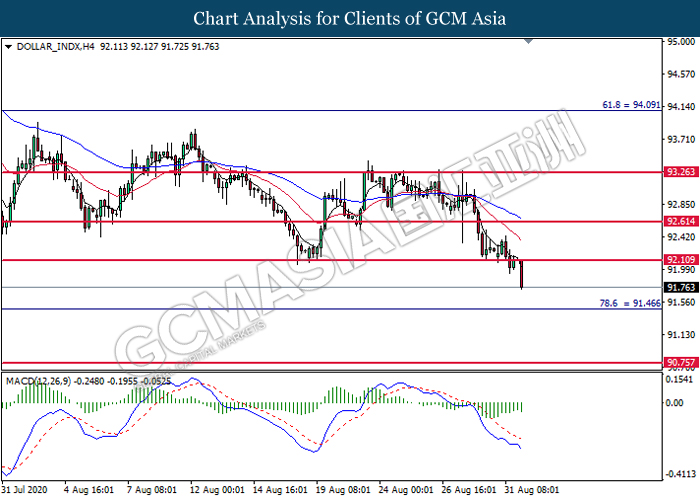

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 92.10. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 91.45.

Resistance level: 92.10, 92.60

Support level: 91.45, 90.75

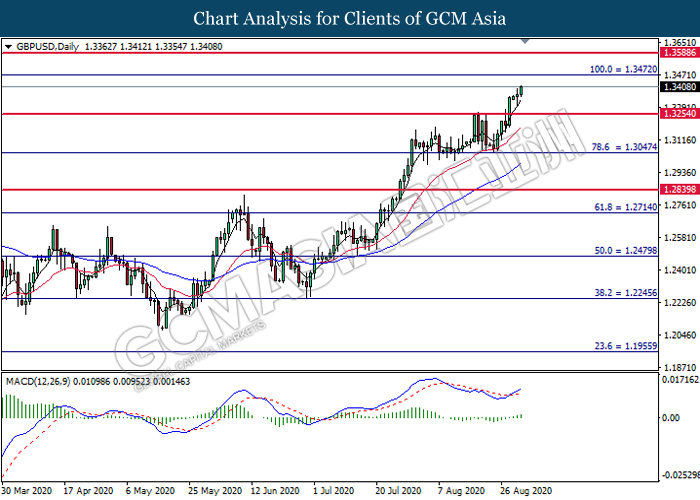

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3255. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.3470.

Resistance level: 1.3470, 1.3590

Support level: 1.3255, 1.3045

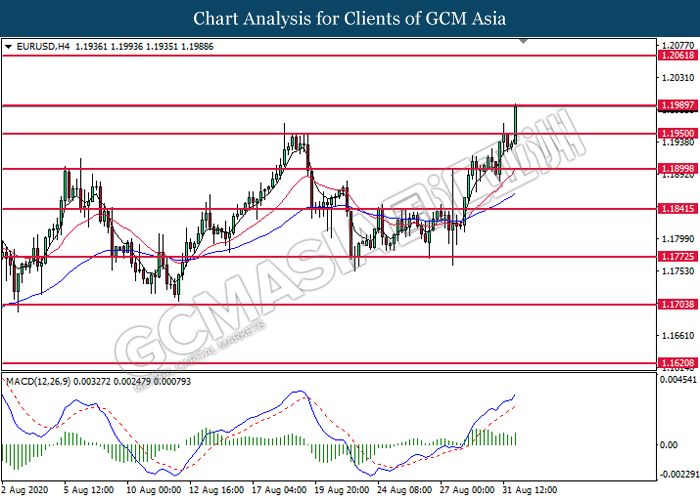

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1990. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1990, 1.2060

Support level: 1.1950, 1.1900

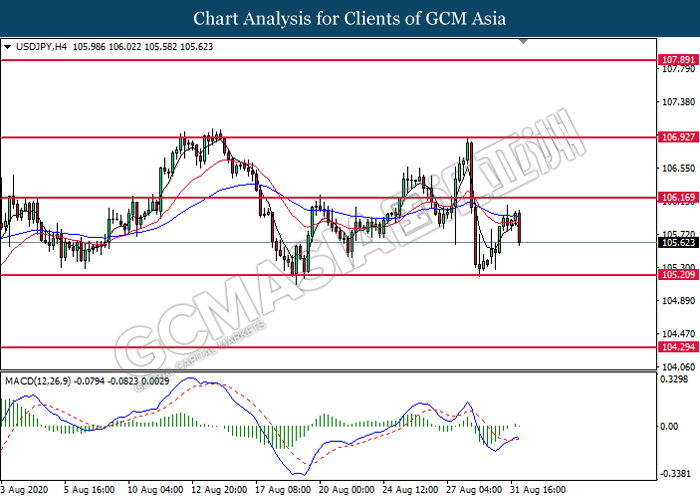

USDJPY, H4: USDJPY was traded lower following prior retracement near the resistance level at 106.15. MACD which illustrates diminishing bullish momentum suggest the pair to extend its retracement toward the support level at 105.20.

Resistance level: 106.15, 106.95

Support level: 105.20, 104.30

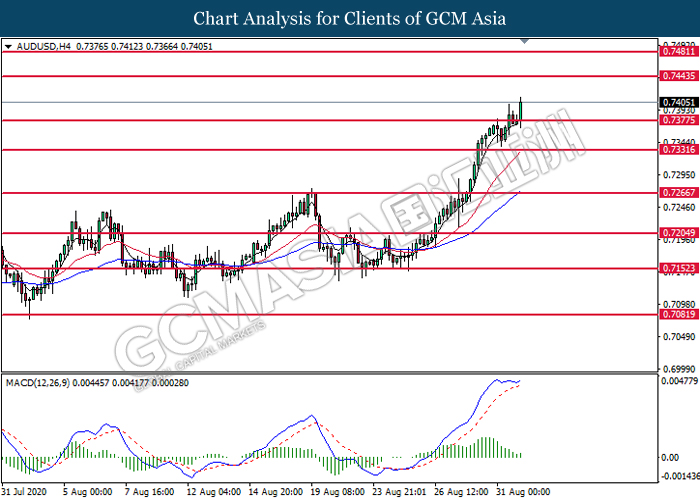

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7380. MACD which illustrated bullish bias momentum suggest the pair to be traded higher toward the resistance level at 0.7445.

Resistance level: 0.7445, 0.7480

Support level: 0.7380, 0.7330

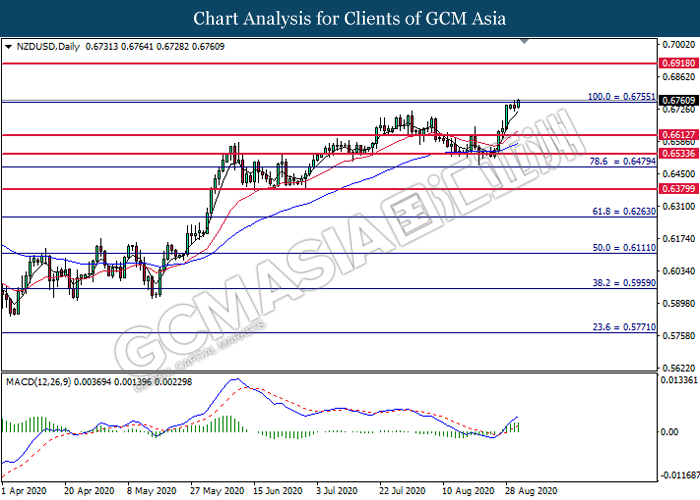

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6755. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above resistance level at 0.6755.

Resistance level: 0.6755, 0.6920

Support level: 0.6615, 0.6535

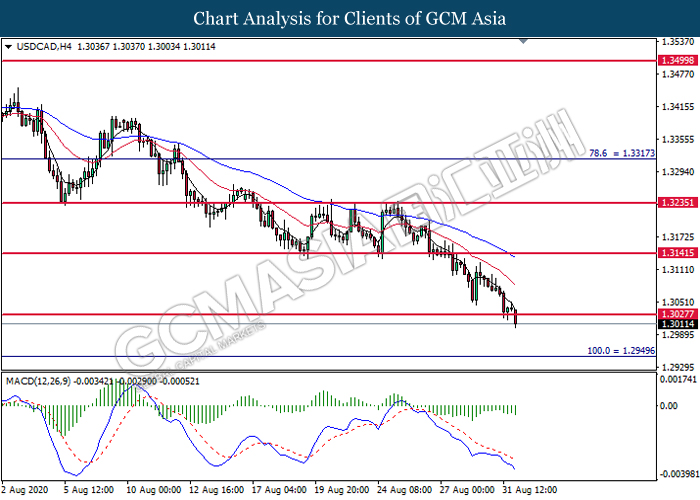

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3030. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3140, 1.3235

Support level: 1.3030, 1.2950

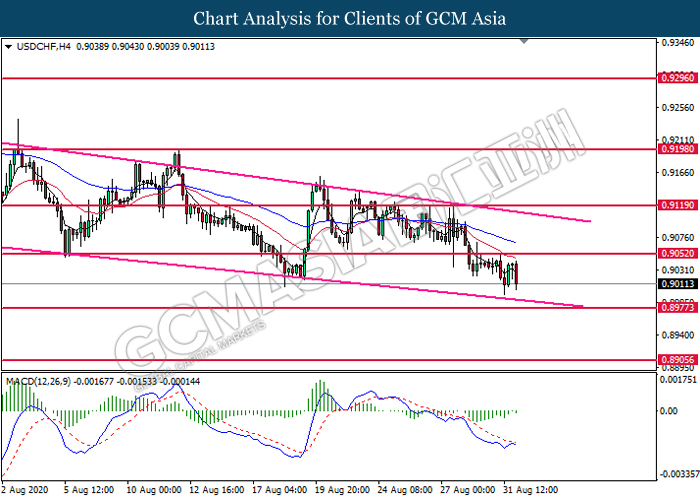

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9050. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 0.9050, 0.9120

Support level: 0.8975, 0.8905

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 42.75. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 43.50.

Resistance level: 43.50, 44.35

Support level: 42.75, 42.05

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1905.85. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 2069.75.

Resistance level: 2069.75, 2147.50

Support level: 1905.85, 1761.65