01 September 2020 Morning Session Analysis

Dollar extend losses amid signal of prolonged low rates.

During early Asian session, the dollar index which traded against a basket of six major currency pairs have fell and reach 2 year low following signals from Fed Vice Chairman to maintain low and longer interest rates. Recently, the Fed has adjusted its policy after Chairman Jerome Powell laying out a plan to allow inflation to run above the 2% target in order boost job growth and the economy. On top of that, Fed Vice Chairman Richard Clarida also mention that the central bank may revisit the idea of yield curve control which is a measure to curb against interest rates increasing too quickly that will in turn hurt lending activity. The plan to focus on inflation would eroded the purchasing power of the dollar, thus weighing negatively on the greenback which also continue to pressure the dollar. At the time of writing, dollar index fell 0.23% to 92.13.

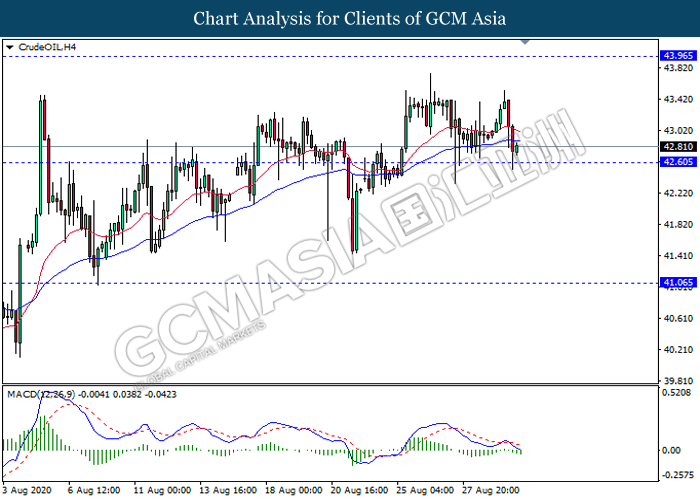

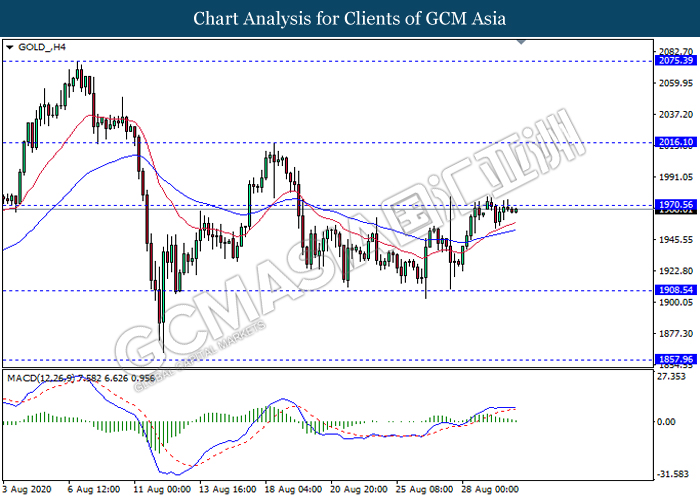

In the commodities market, crude oil price remain buoyant and rose 0.11% to $42.84 per barrel as of writing following rising demand from China. According to reports, China oil demand is stated to have risen by 16.7% at 14.16 million barrels per day which reflects the strength of China’s economic recovery. China imports of U.S crude oil also reach a record high last month and expected to rise further in September due to U.S-China trade talks. On the other hand, gold price remains stable and edge higher 0.08% to $1966.85 a troy ounce at the time of writing following ongoing dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12.30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12.30 | AUD – RBA Interest Rate Decision (Sep) | 0.25% | 0.25% | – |

| 15.55 | EUR – German Manufacturing PMI (Aug) | 53.0 | 53.0 | – |

| 15.55 | EUR – German Unemployment Change (Aug) | -18K | 1K | – |

| 16.30 | GBP – Manufacturing PMI (Aug) | 55.3 | 55.3 | – |

| 17.00 | EUR – CPI (YoY) (Aug) | 0.4% | 0.2% | – |

| 22.00 | USD – ISM Manufacturing PMI (Aug) | 54.2 | 54.5 |

Technical Analysis

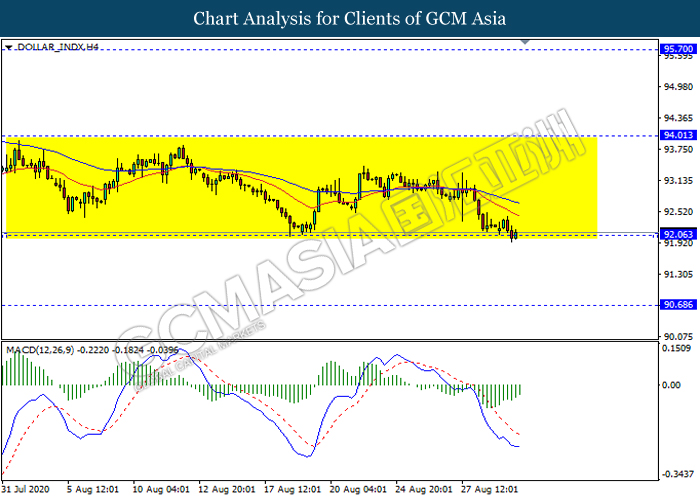

DOLLAR_INDX, H4: Dollar index remain traded in a sideway channel while currently testing the support level 92.05. However, MACD which illustrate diminishing bearish momentum suggested the dollar to experience a technical correction towards the resistance level94.00.

Resistance level: 94.00, 95.70

Support level: 92.05, 90.70

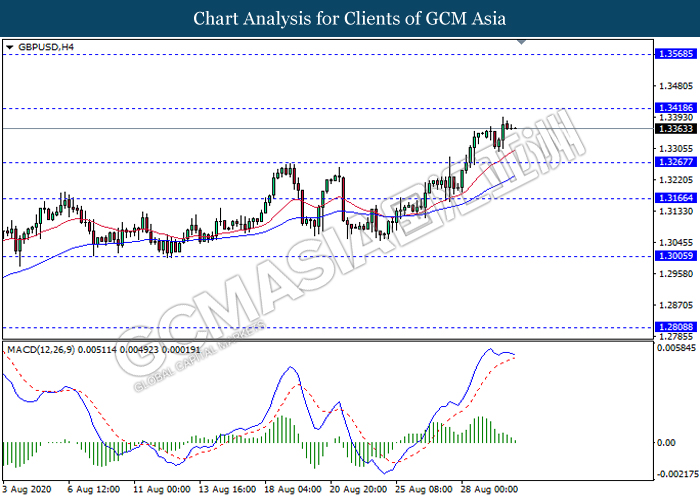

GBPUSD, H4: GBPUSD was traded higher while currently testing near the resistance level 1.3420. However, MACD which display diminishing bullish momentum suggested the pair to experience a technical correction towards the support level 1.3265.

Resistance level: 1.3420, 1.3570

Support level: 1.3265, 1.3165

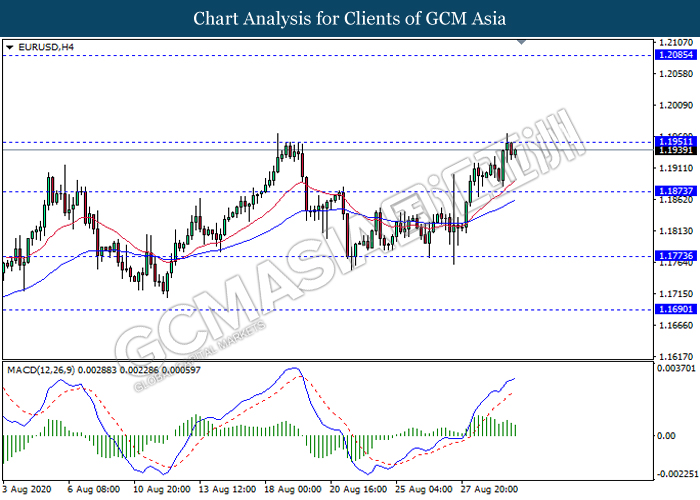

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level 1.1950. However, MACD which illustrate diminishing bullish momentum suggested the pair to be traded lower as a technical correction in short term towards the support level 1.1875.

Resistance level: 1.1950, 1.2085

Support level: 1.1875, 1.1775

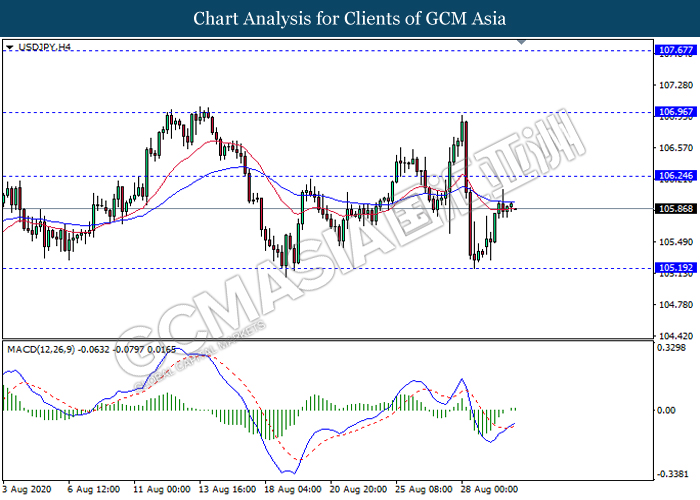

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 105.20. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 106.25.

Resistance level: 106.25, 106.95

Support level: 105.20, 104.35

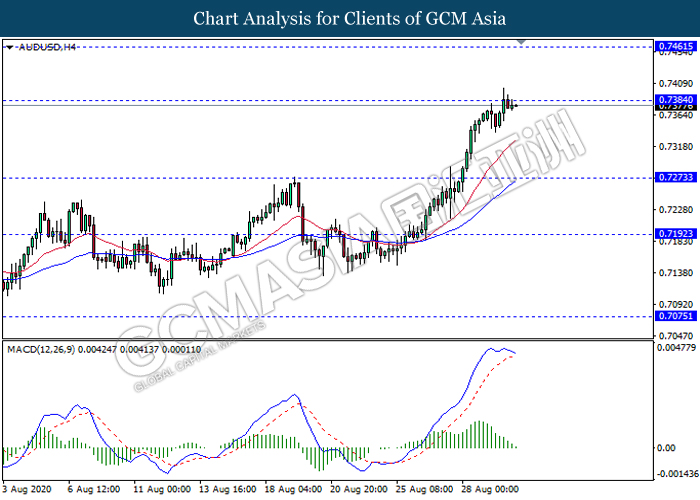

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level 0.7385. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction towards the support level 0.7275.

Resistance level: 0.7385, 0.7460

Support level: 0.7275, 0.7190

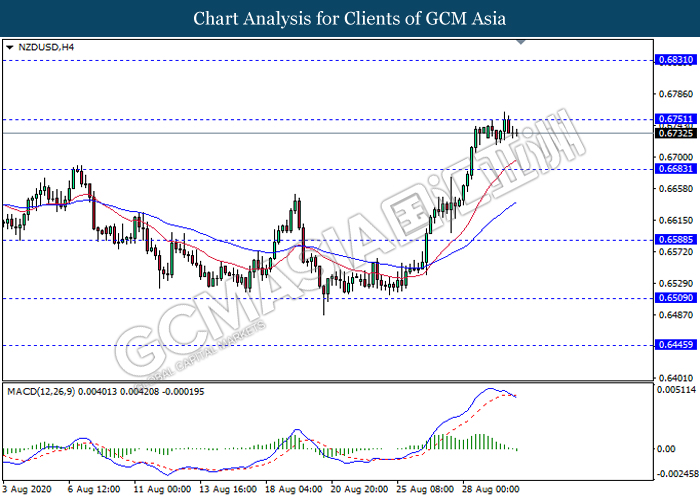

NZDUSD, H4: NZDUSD was traded flat near the resistance level 0.6750. However, MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to be traded lower as a technical correction towards the support level 0.6685.

Resistance level: 0.6750, 0.6830

Support level: 0.6685, 0.6590

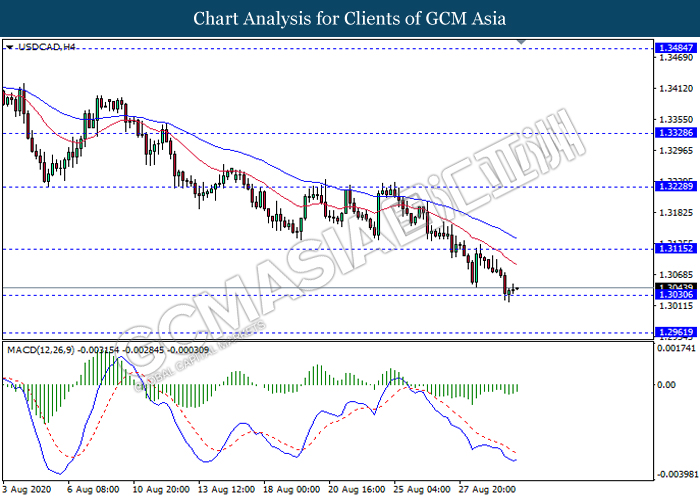

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.3030. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher as a short term technical correction towards the resistance level 1.3115.

Resistance level: 1.3115, 1.3230

Support level: 1.3030, 1.2960

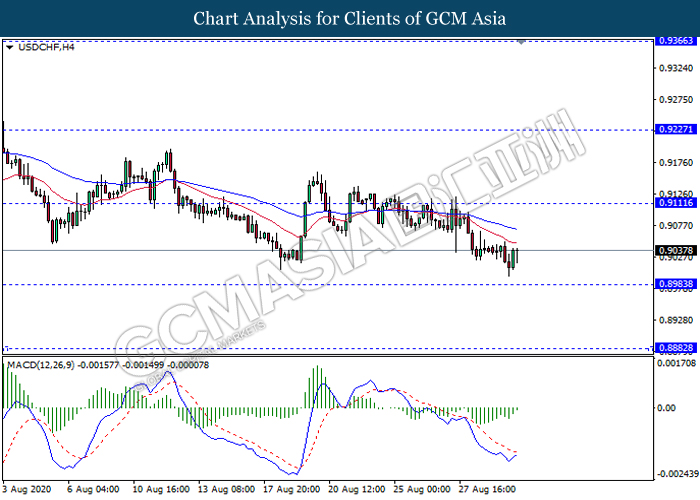

USDCHF, H4: USDCHF was traded lower while currently testing near the support level 0.8985. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a technical correction towards the resistance level 0.9110.

Resistance level: 0.9110, 0.9225

Support level: 0.8985, 0.8880

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 42.60. MACD which illustrate bearish bias signal suggest the commodity to extend its losses after it breaks below the support level 42.60.

Resistance level: 43.95, 46.20

Support level: 42.60, 41.05

GOLD_, H4: Gold price was traded higher while currently testing the resistance level 1970.55. However, MACD which display diminishing bullish momentum signal suggest the commodity to be traded lower as a technical correction towards the support level 1908.55.

Resistance level: 1970.55, 2016.10

Support level: 1908.55, 1857.95