1 December 2021 Afternoon Session Analysis

Aussie rebound on upbeat GDP data.

The Australian dollar which traded against the dollar and other currency pairs have manage to recoup its losses and rebound following the release of positive Australia’s GDP data. According to the Australian Bureau of Statistics, Australia’s GDP for the 3rd quarter came in at to -1.9%, surpassed market expectation of -2.7%. The results were likely to reinforce views that the RBA may taper or potentially even remove its bond buying program early next year. Goldman Sachs stated that the Australia is well positioned for recovery into the year-end and 2022. Besides that, the pair also gains on comments from China Vice Premier. China Vice Premier Liu He stated that he expects strong GDP for 2021 in the mainland. As of writing, AUD/USD rose 0.41% to 0.7151.

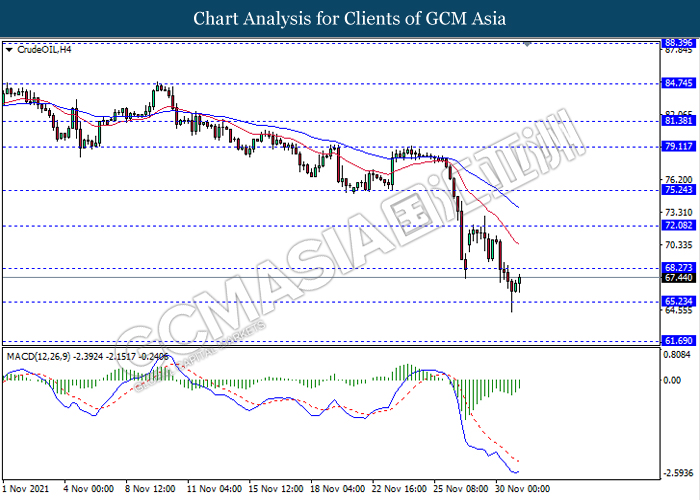

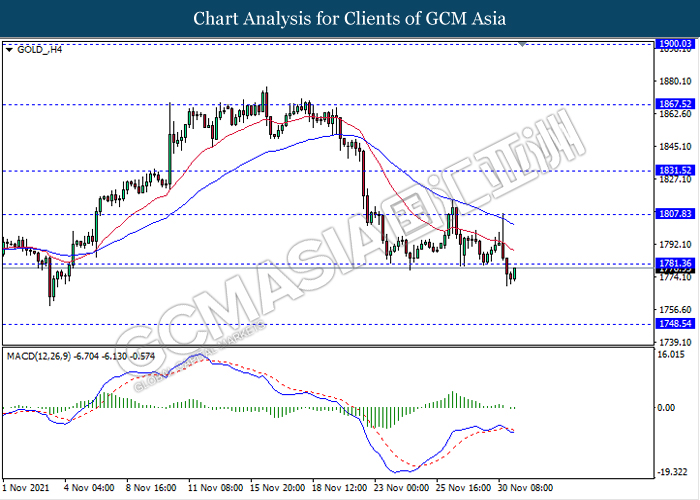

In the commodities market, crude oil price also rebounds 0.80% to $67.45 per barrel as of writing following market currently assessing the potential response from OPEC towards the threat of Omicron variant. The OPEC is expected to meet on Wednesday and Thursday in order to discuss about Omicron and fuel demand. Some analysts expect OPEC+ will pause plans to add 400,000 barrels per day of supply in January while several other OPEC minister stated that there was no need for a change. On the other hand, gold price fell 0.09% to $1778.51 at the time of writing amid dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 GBP BoE Gov Bailey Speaks

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Nov) | 57.6 | 57.6 | – |

| 17:30 | GBP – Manufacturing PMI (Nov) | 58.2 | 58.2 | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Nov) | 571K | 525K | – |

| 23:00 | ISM Manufacturing PMI (Nov) | 60.8 | 61 | – |

| 23:30 | Crude Oil Inventories | 1.017M | -1.237M | – |

Technical Analysis

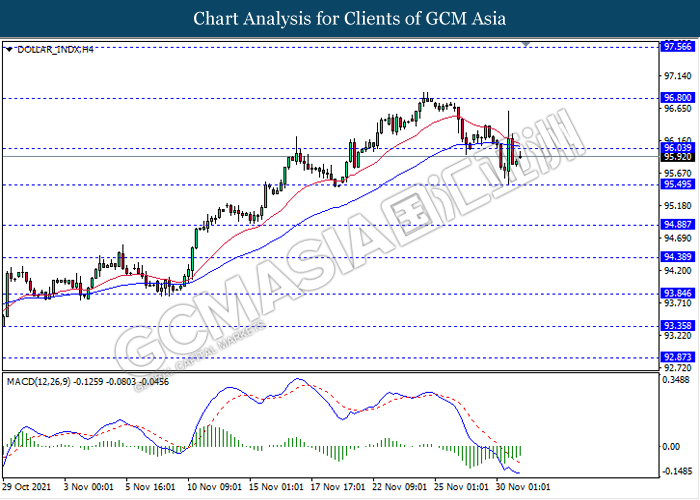

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level 96.05. However, MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend its rebound after it breaks above the resistance level 96.05.

Resistance level: 96.05, 96.80

Support level: 95.30, 94.90

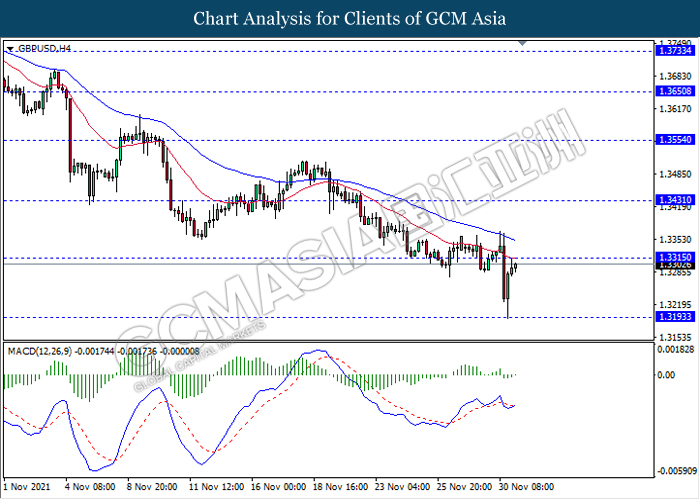

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level 1.3315. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound after it breaks above the resistance level 1.3315.

Resistance level: 1.3315, 1.3430

Support level: 1.3195, 1.3055

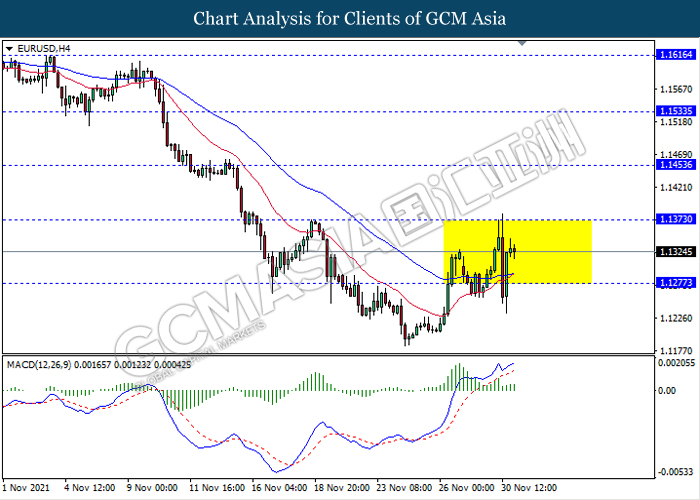

EURUSD, H4: EURUSD was traded in a sideway channel. However, MACD which illustrate bullish bias signal suggest the pair to be traded higher after it breaks above the resistance level 1.1375.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1170

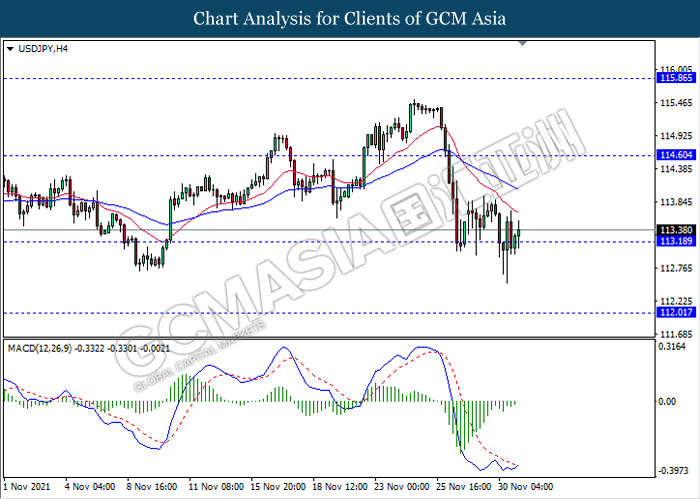

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 113.20. MACD which illustrate diminishing bearish momentum signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 114.60.

Resistance level: 114.60, 115.85

Support level: 113.20, 112.00

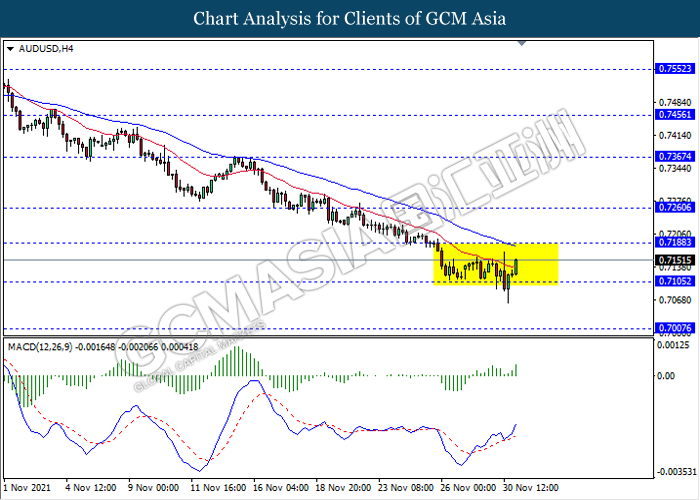

AUDUSD, H4: AUDUSD remain traded in a sideway channel following recent rebound from the support level 0.7105. However, MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 0.7190.

Resistance level: 0.7190, 0.7260

Support level: 0.7105, 0.7005

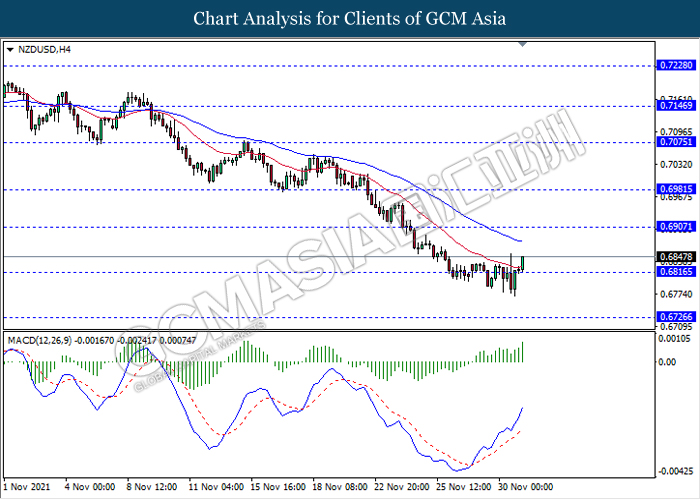

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6815. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound toward the resistance level 0.6905.

Resistance level: 0.6905, 0.6980

Support level: 0.6815, 0.6725

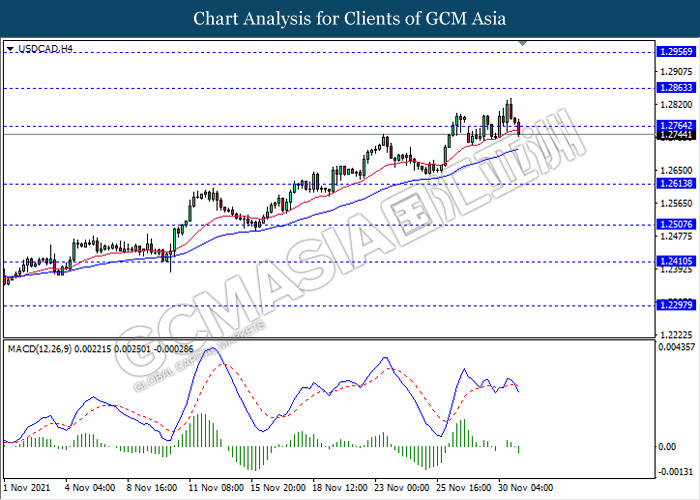

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level 1.2765. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 1.2615.

Resistance level: 1.2765, 1.2865

Support level: 1.2615, 1.2505

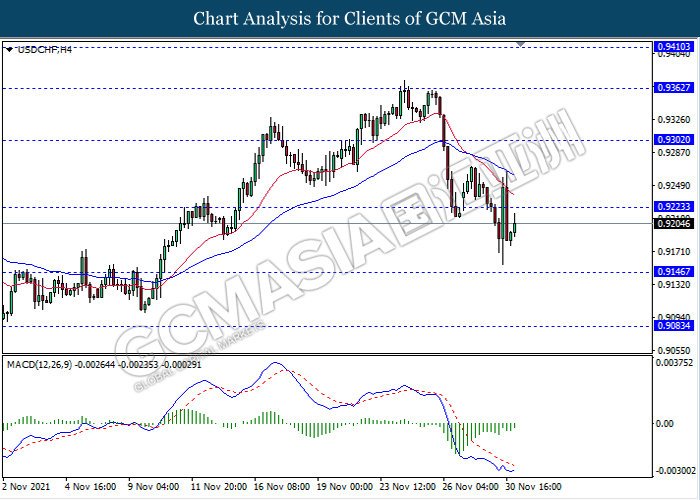

USDCHF, H4: USDCHF was traded higher while currently testing near the resistance level 0.9225. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound after it breaks above the resistance level 0.9225.

Resistance level: 0.9225, 0.9300

Support level: 0.9145, 0.9085

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level 68.25. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its rebound after it breaks above the resistance level.

Resistance level: 68.25, 72.10

Support level: 65.25, 61.70

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level 1781.35. MACD which illustrate bearish momentum signal with the formation of death cross suggest the commodity to extend its losses towards the support level 1748.55.

Resistance level: 1781.35, 1807.85

Support level: 1748.55, 1725.70