01 December 2021 Morning Session Analysis

Dollar surged amid hawkish tone from Fed.

The Dollar Index which traded against a basket of six major currency pairs surged over the backdrop of hawkish statement from the Federal Reserve yesterday. According to Reuters, US Federal Reserve Chair Jerome Powell claimed on Tuesday that the Monetary Policy Committee (MPC) will start to discuss whether to diminish their bond purchases a few months earlier than had been anticipated, citing that a strong economy, stalled workforce growth as well as high inflation pressure would be expected to last until mid-2022. The inflation had jumped to its highest level in three decades and new Covid-19 variant, Omicron, continue to spur negative prospect toward the global economic growth. Besides, the concerns over the supply and demand mismatches remain and increase the stagflation risk in future. In earlier, the central bank had been buying $120 billion in government-backed securities each month throughout the pandemic in order to boost up the economy by stabilizing the money circulation in the financial market. As of writing, the Dollar Index appreciated by 0.03% to 95.95.

In the commodities market, the crude oil price slumped 0.05% to 67.55 per barrel as of writing. The oil market edged lower following the Moderna’s CEO claimed that he believes that the current Covid-19 vaccines will not be as effective against the Omicron Variant, dragging down the appeal for this black-commodity. On the other hand, the gold price depreciated by 0.04% to $1775.45 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 GBP BoE Gov Bailey Speaks

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Nov) | 57.6 | 57.6 | – |

| 17:30 | GBP – Manufacturing PMI (Nov) | 58.2 | 58.2 | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Nov) | 571K | 525K | – |

| 23:00 | ISM Manufacturing PMI (Nov) | 60.8 | 61 | – |

| 23:30 | Crude Oil Inventories | 1.017M | -1.237M | – |

Technical Analysis

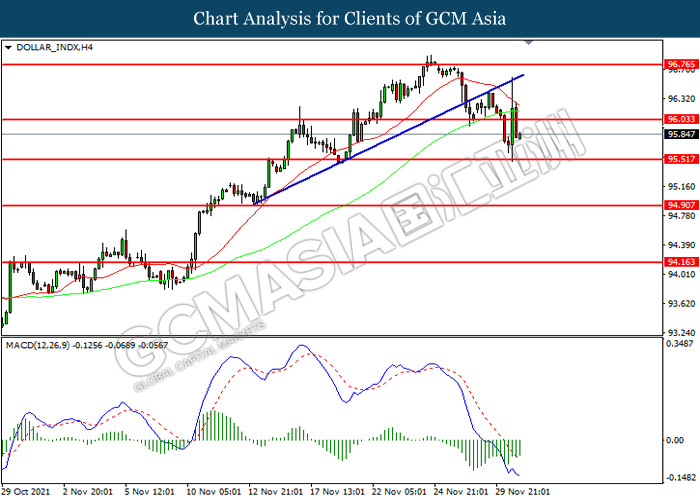

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 96.05. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 96.05, 96.75

Support level: 95.50, 94.90

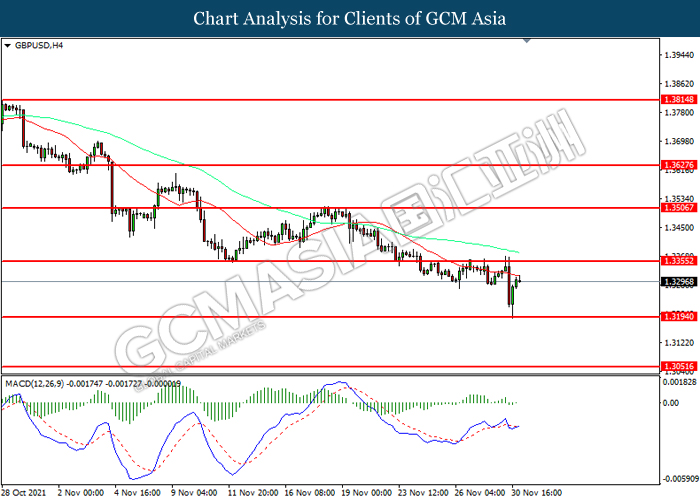

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3355, 1.3505

Support level: 1.3195, 1.3050

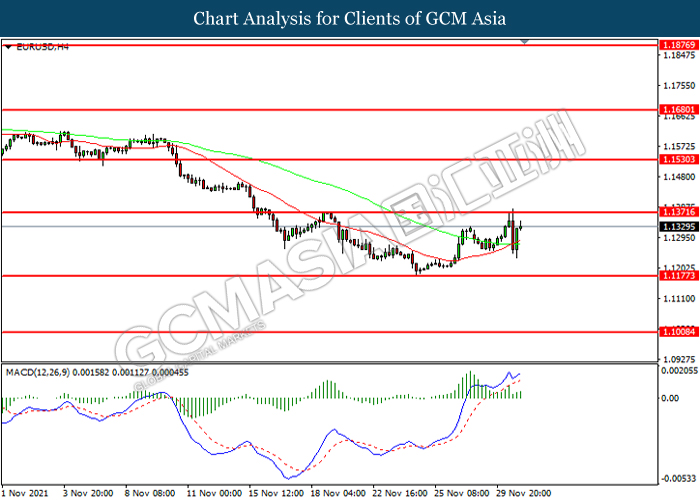

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1370. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1370, 1.1530

Support level: 1.1175, 1.1010

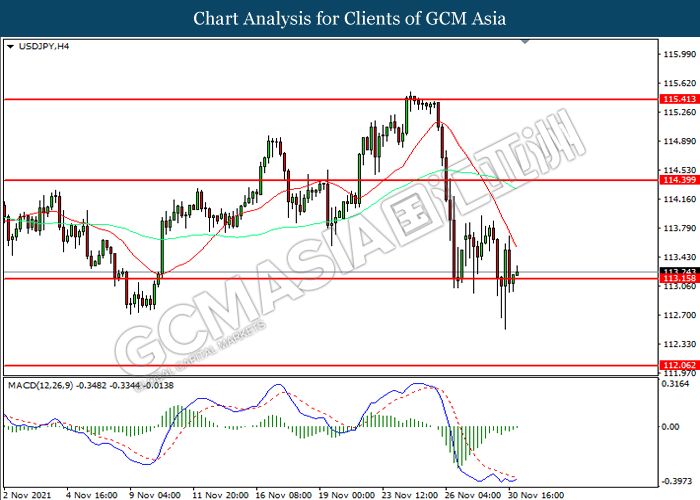

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.15. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 114.40, 115.40

Support level: 113.15, 112.05

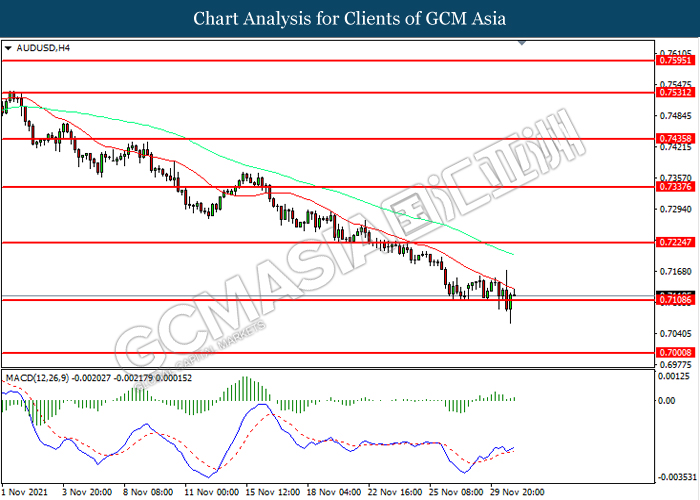

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7110. However. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7225, 0.7335

Support level: 0.7110, 0.7000

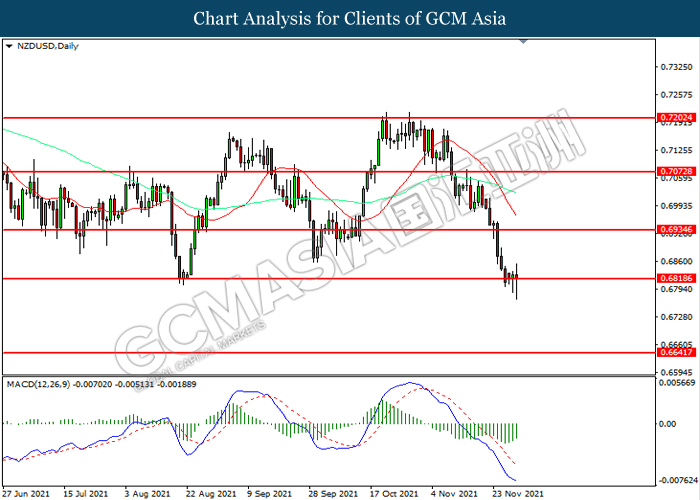

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6820. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6935, 0.7075

Support level: 0.6820, 0.6640

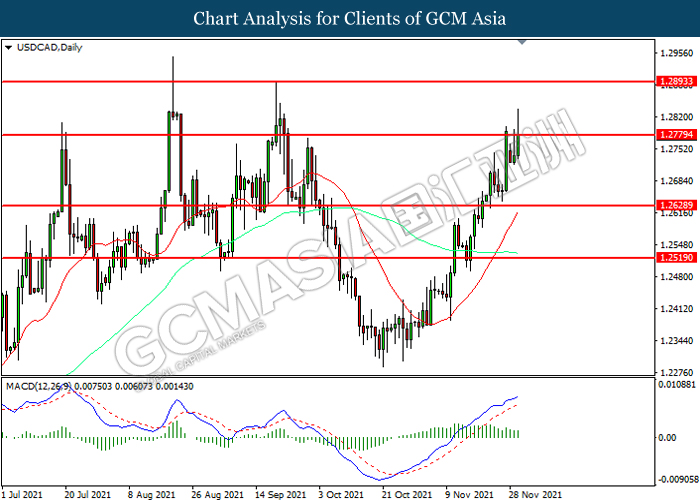

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2780. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2780, 1.2895

Support level: 1.2630, 1.2520

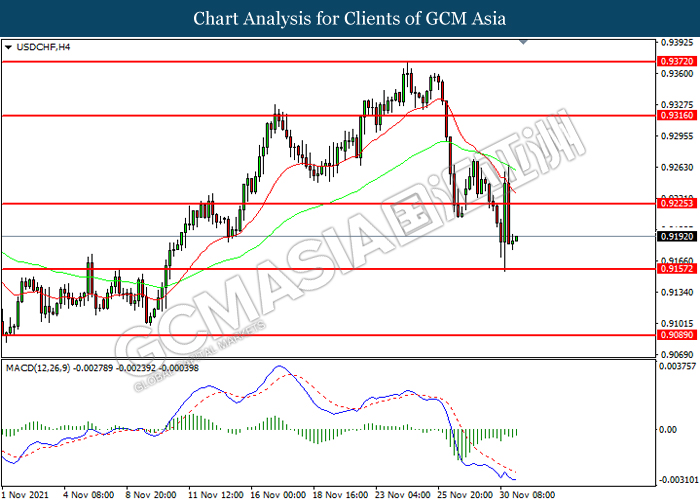

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9155. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9225, 0.9315

Support level: 0.9155, 0.9090

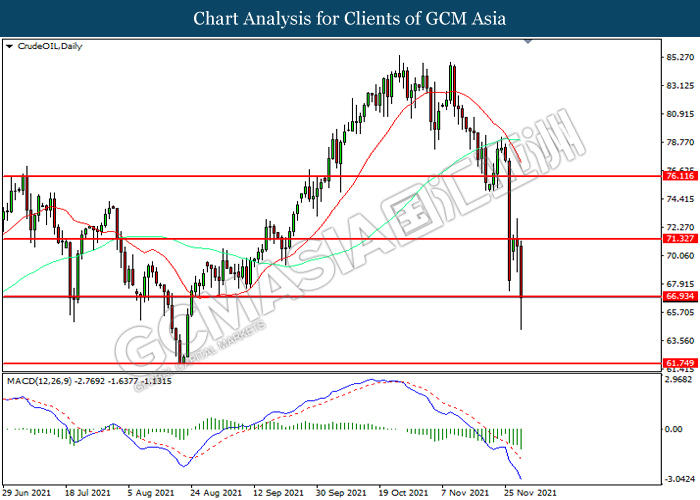

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.95 MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.35, 76.10

Support level: 66.95, 61.75

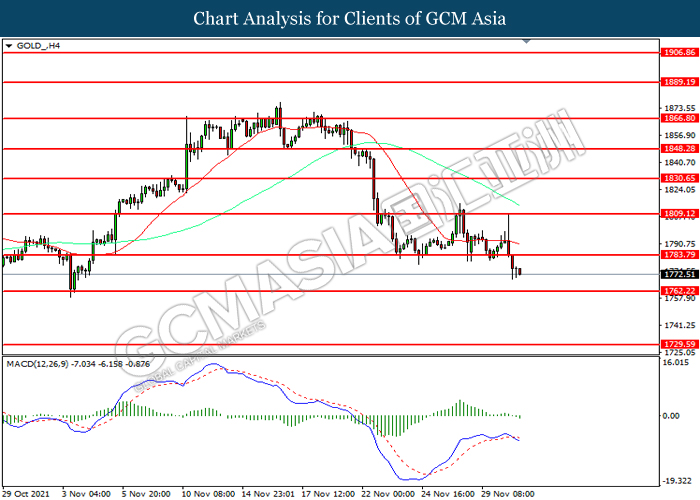

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1783.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1762.20.

Resistance level: 1783.80, 1809.10

Support level: 1762.20, 1729.60

Risk Statement:

Forex, Gold, Crude Oil, Commodities, CFD and all other margin trading investment products involve high level of risk and may not be suitable for all investors. Your previous investment success in stock, futures or any other investment achieved does not mean that all your future investment will obtain the same results. You should carefully consider your investment objectives; risk associated and seek professional advice before deciding to trade or if you have any doubts.