1 December 2022 Afternoon Session Analysis

Euro surged despite inflation started to cooldown.

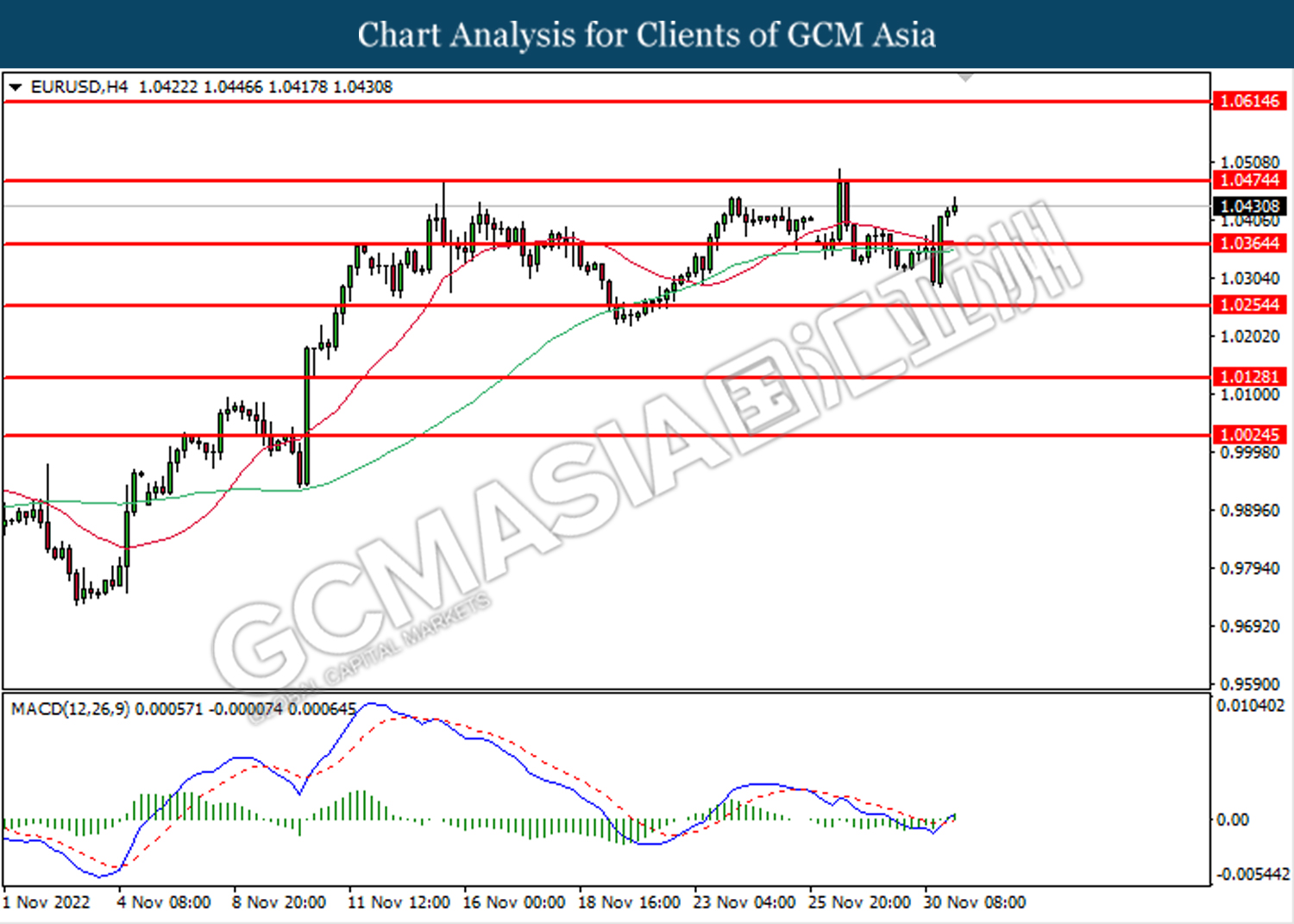

The Euro, which was majorly traded by global investors, jumped despite the fact that the inflationary pressures in the Eurozone have started to ease in the last month. According to the statistical office of the European Union, the inflation figures are down from 10.6% to 10.0%, missing the economist forecast of 10.4%, reinforcing the case for a slowdown in European Central Bank rate hikes in the coming central bank meeting. In detail, the major dragger of the inflation figure in November was a substantial drop in energy prices. With that, the ECB is likely to take a slower pace of rate hike in the next meeting to tackle inflation. However, the significant drop in the dollar index urged the pairing of EUR/USD to skyrocket to a high level. Early today, the chairman of the Federal Reserve commented that the US central bank would scale back the pace of its rate hike plan alongside the inflationary pressures has started to ease over the past few months. As of writing, the pairing of EUR/USD rose 0.23% to 1.0430.

In the commodities market, the crude oil price edged up by 0.04% to $81.02 per barrel as a few of China’s districts eased the Covid-19 lockdown measures. Besides, the gold prices edged up 0.38% to $1775.40 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Nov) | 46.7 | 46.7 | – |

| 17:30 | GBP – Manufacturing PMI (Nov) | 46.2 | 46.2 | – |

| 21:30 | USD – Core PCE Price Index (MoM) (Oct) | 0.5% | 0.3% | – |

| 21:30 | USD – Initial Jobless Claims | 240K | 235K | – |

| 23:00 | USD – ISM Manufacturing PMI (Nov) | 50.2 | 49.8 | – |

Technical Analysis

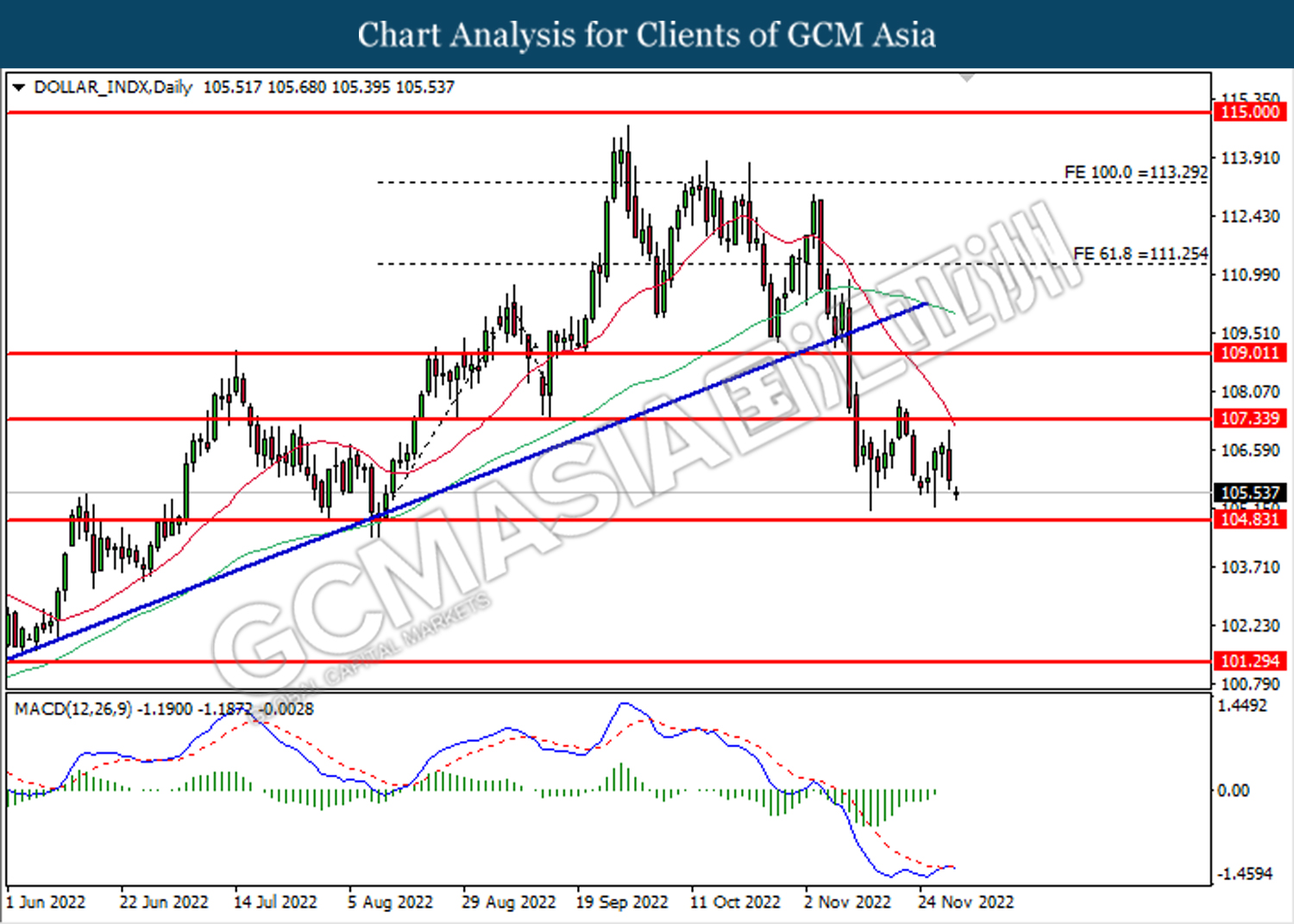

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

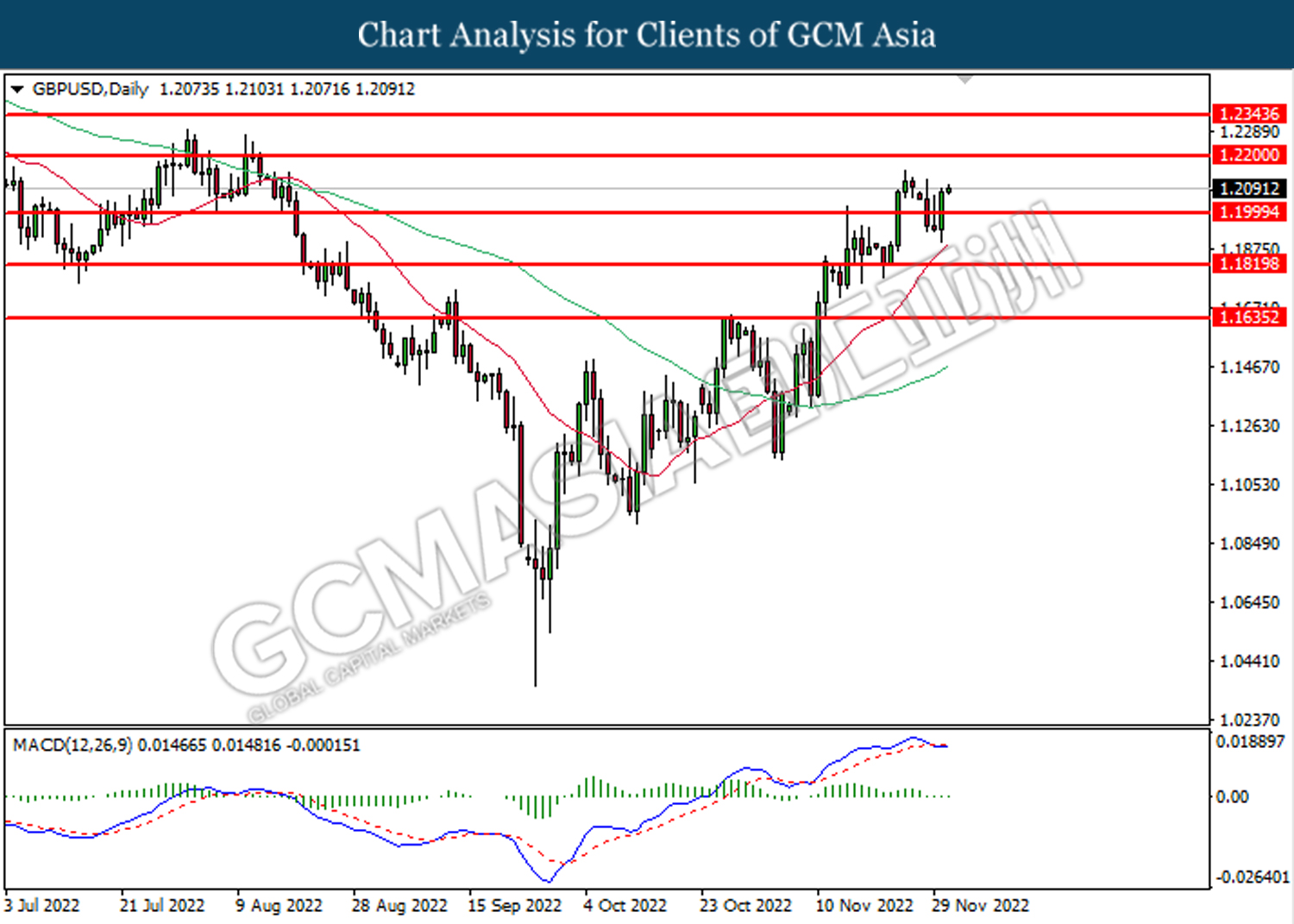

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0475.

Resistance level: 1.0475, 1.0615

Support level: 1.0365, 1.0255

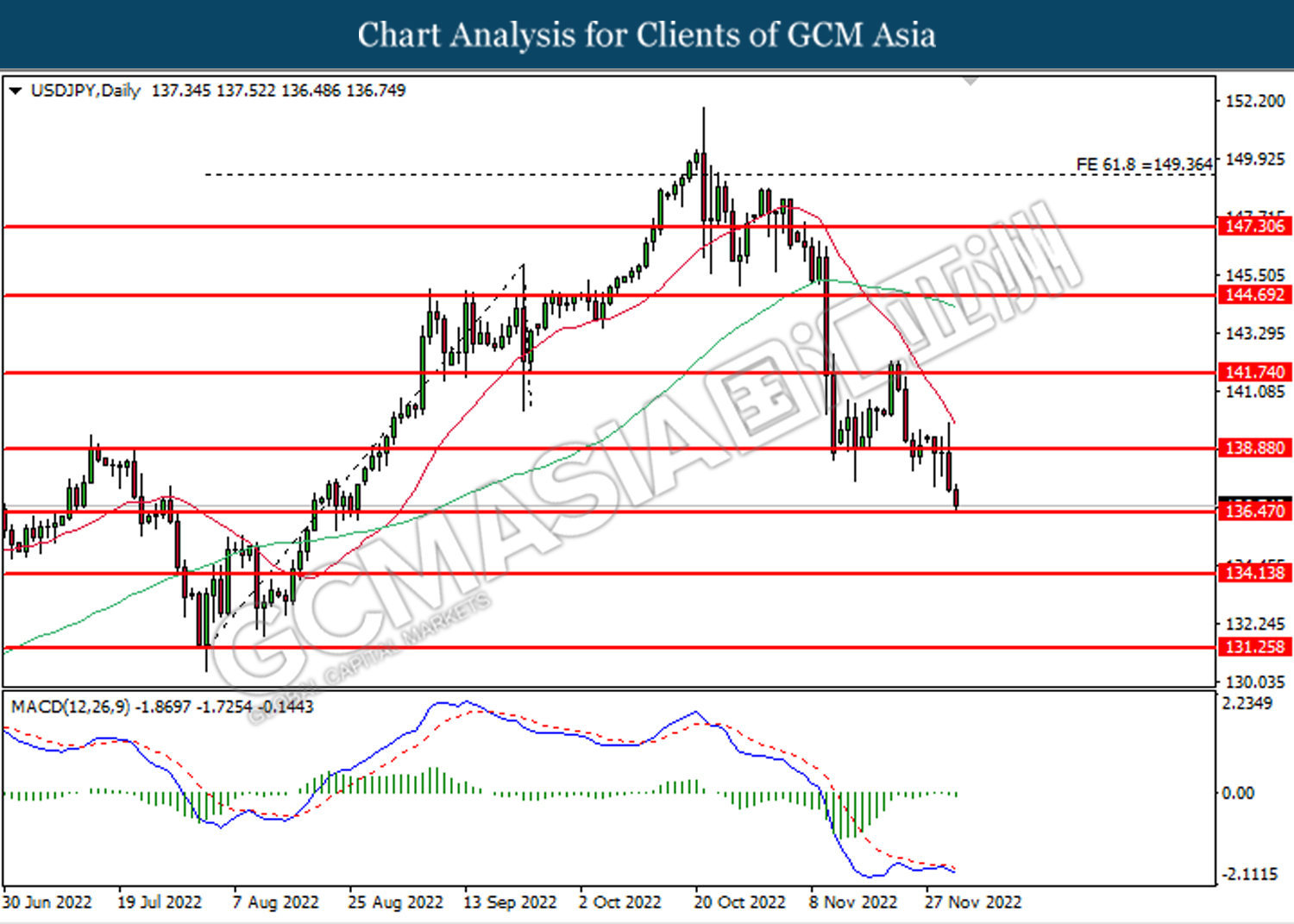

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.45. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 138.90, 141.75

Support level: 136.45, 134.15

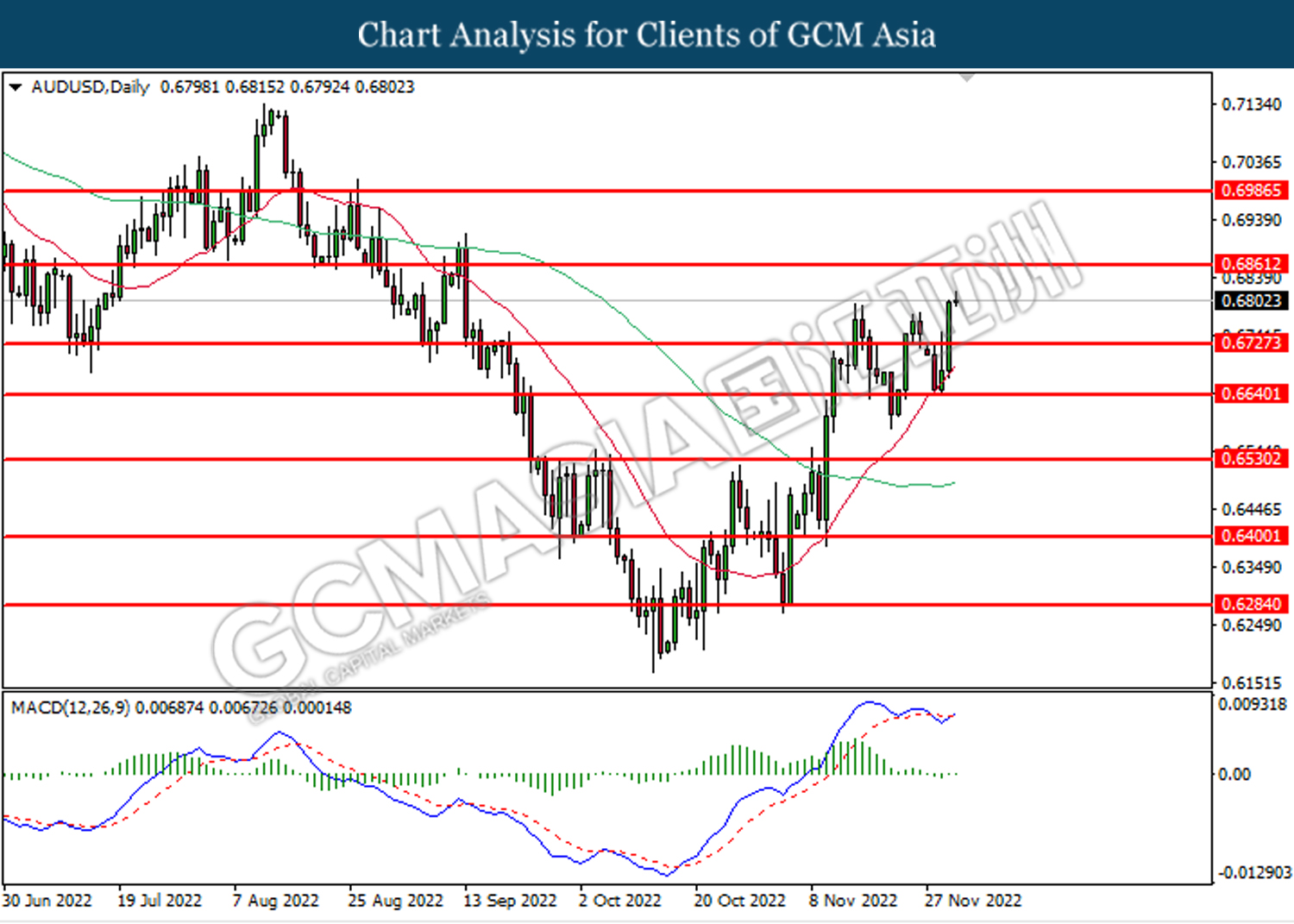

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

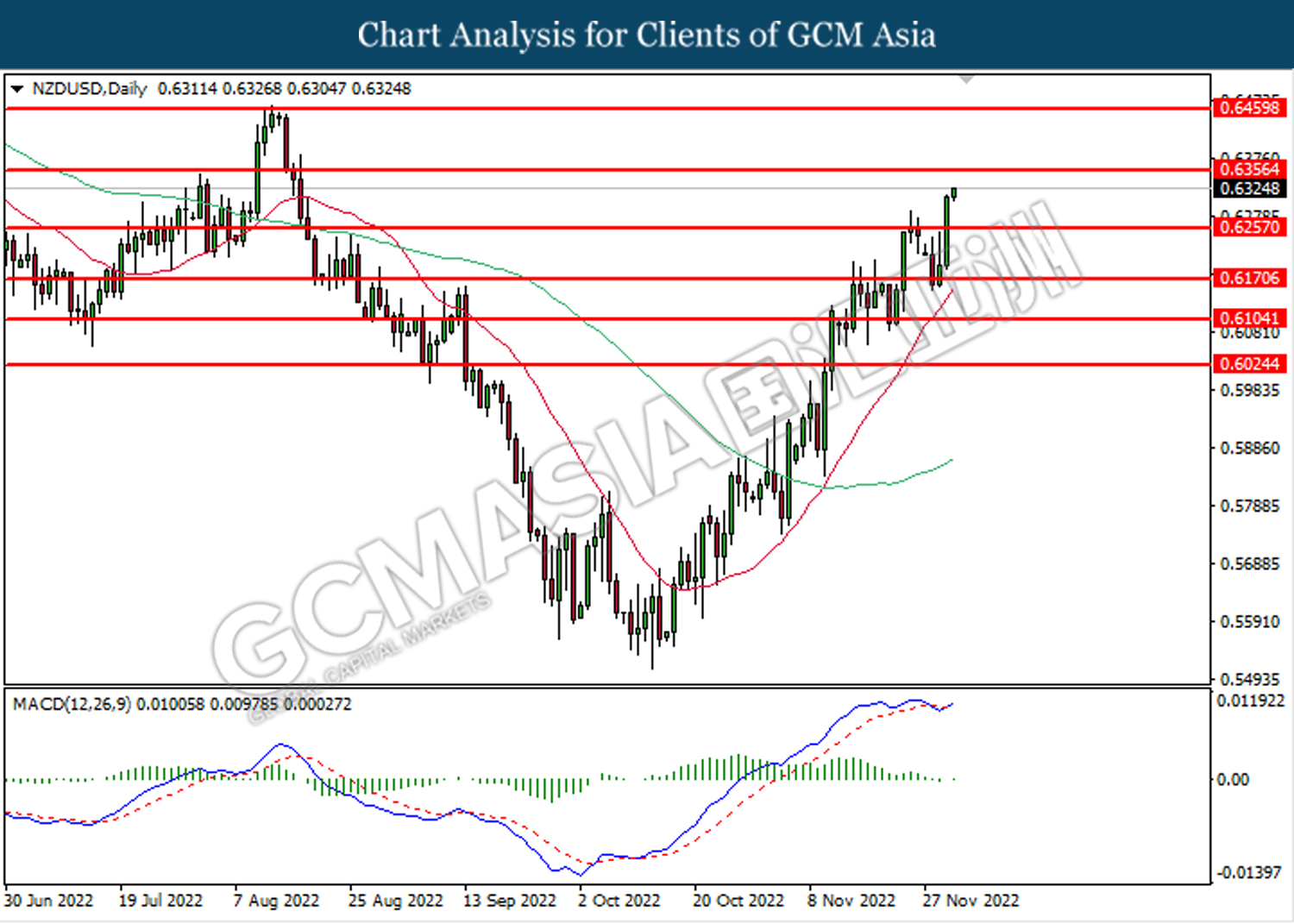

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6255. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

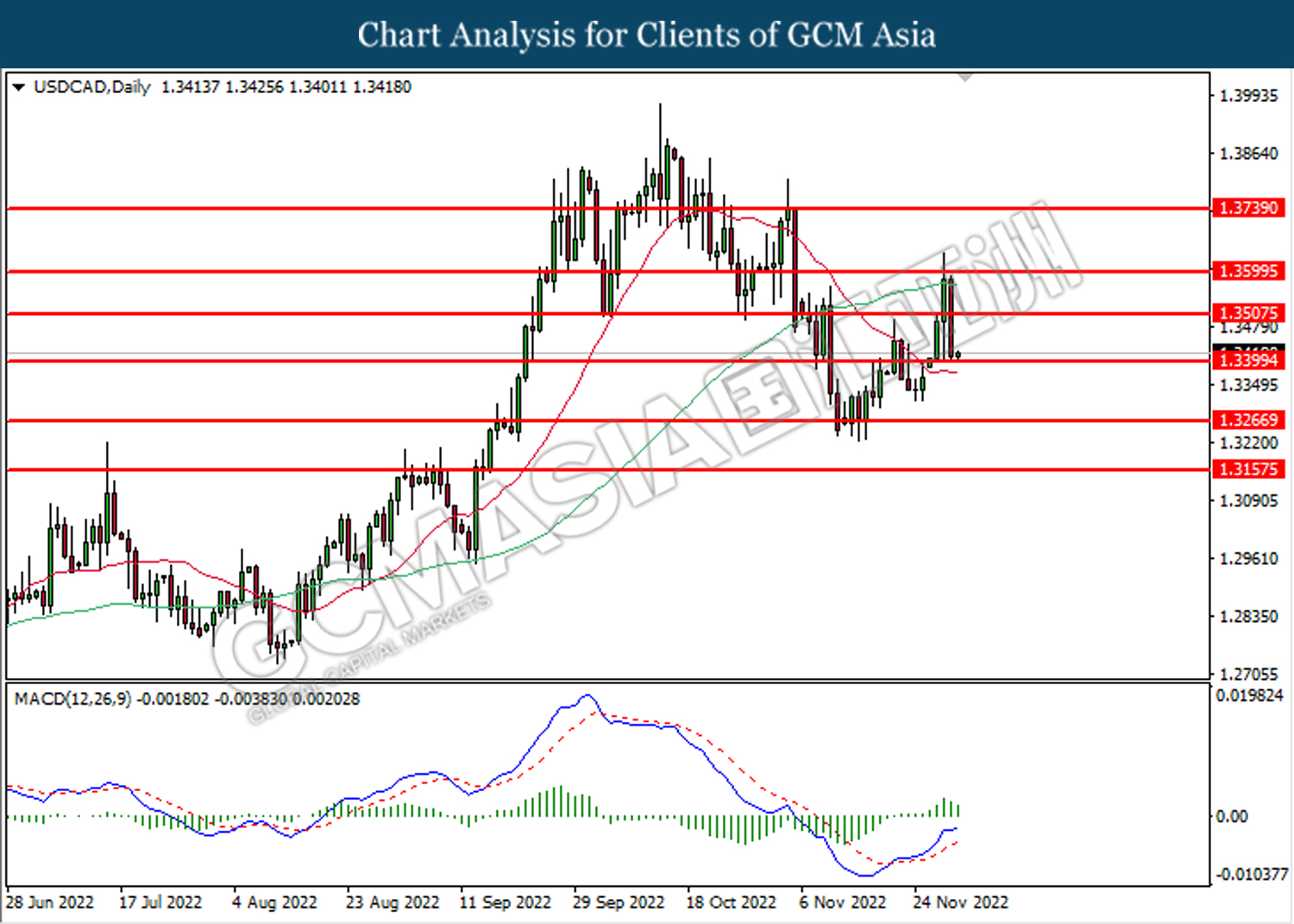

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

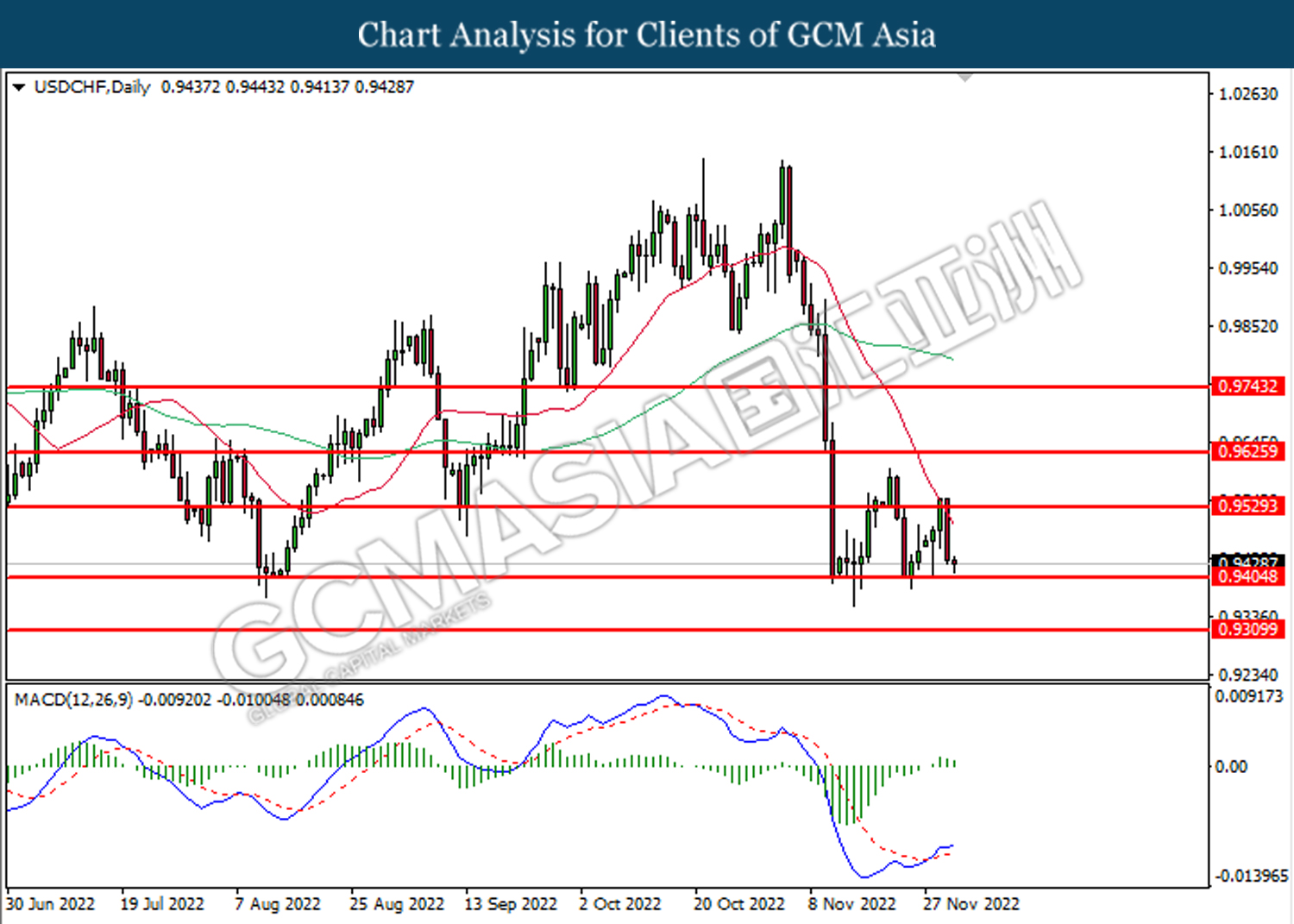

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

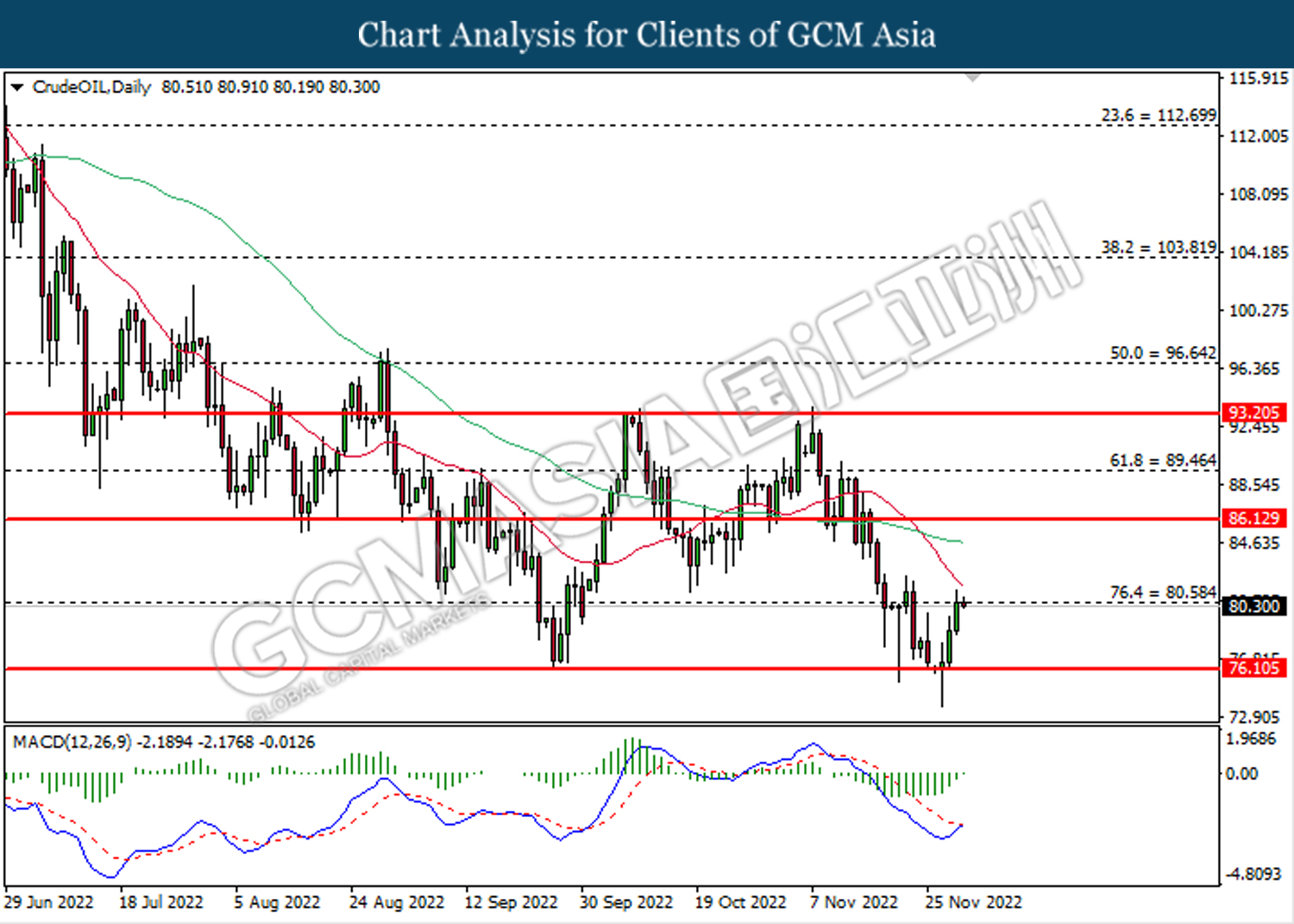

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.60. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

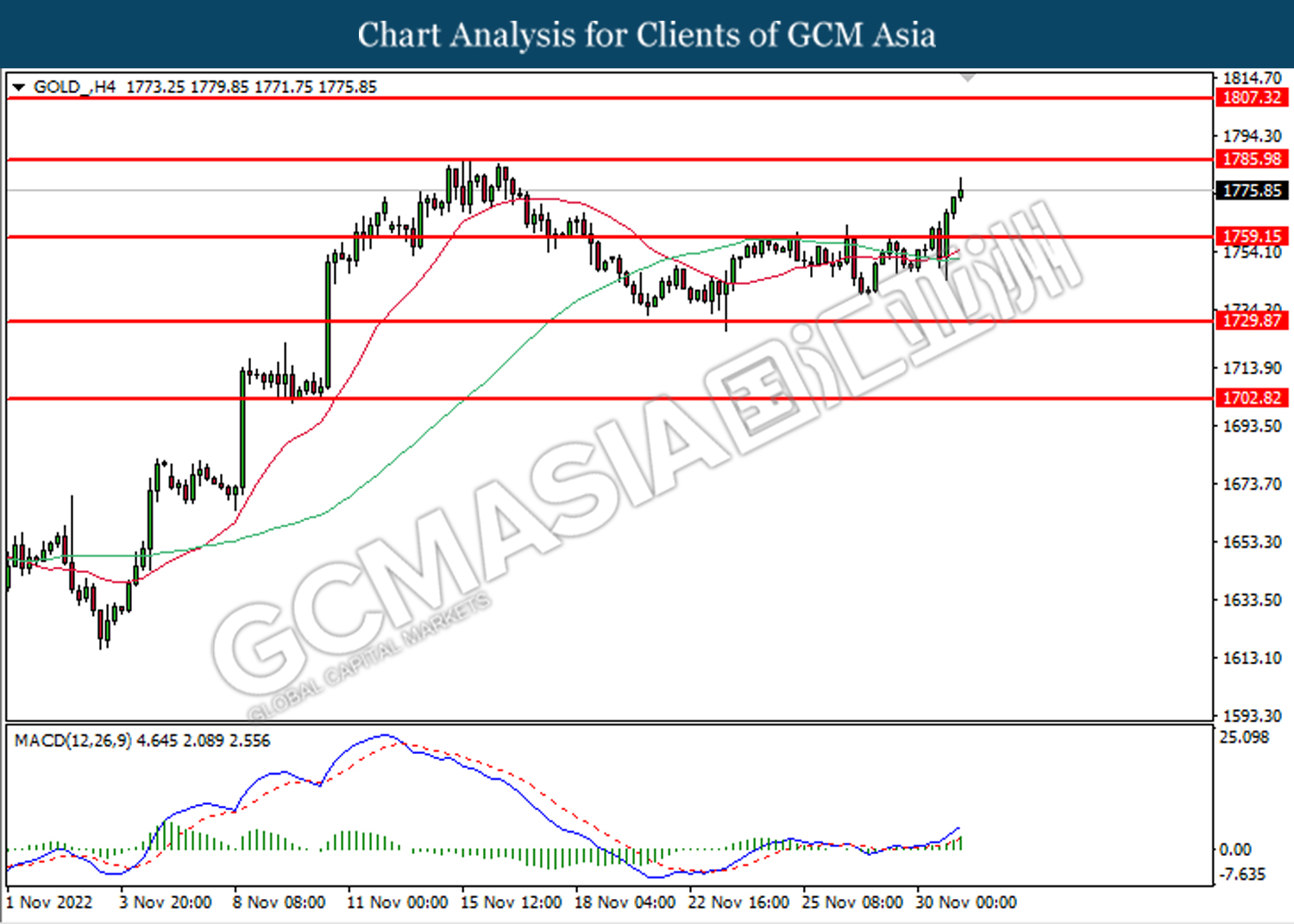

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1786.00.

Resistance level: 1786.00, 1807.30

Support level: 1759.15, 1729.85