1 December 2022 Morning Session Analysis

US Dollar’s bear continued following dovish speech from Fed chairman.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday early trading session amid the background of dovish statement from Fed. According to Reuters, the Federal Reserve Chairman Jerome Powell appeared a speech on Thursday that the aggressive rate hike pace could be slowed, and it may come as soon as the December meeting. In addition, he also acknowledged that the current level of interest rates were approaching “the level of restraint that will be sufficient to bring inflation down”, which further increased the odds of softer rate hike in the next meeting. Though, it is noteworthy that he reiterated that the rates were still a long way from peak levels. On the economic data front, a series of upbeat economic data has limited the losses of the Dollar Index. The data such as US Gross Domestic Product (GDP), JOLTs Job Openings and Pending Home Sales has given a better-than-forecast reading, which spurred bullish momentum toward US Dollar. As of writing, the Dollar Index depreciated by 0.79% to 105.92.

In the commodities market, the crude oil price appreciated by 0.09% to $80.55 per barrel as of writing following the diminishing of crude oil inventories. According to EIA, the US Crude Oil Inventories decreased by -12.580M barrels, higher than the expectation of market. On the other hand, the gold price rose by 0.29% to $1774.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Nov) | 46.7 | 46.7 | – |

| 17:30 | GBP – Manufacturing PMI (Nov) | 46.2 | 46.2 | – |

| 21:30 | USD – Core PCE Price Index (MoM) (Oct) | 0.5% | 0.3% | – |

| 21:30 | USD – Initial Jobless Claims | 240K | 235K | – |

| 23:00 | USD – ISM Manufacturing PMI (Nov) | 50.2 | 49.8 | – |

Technical Analysis

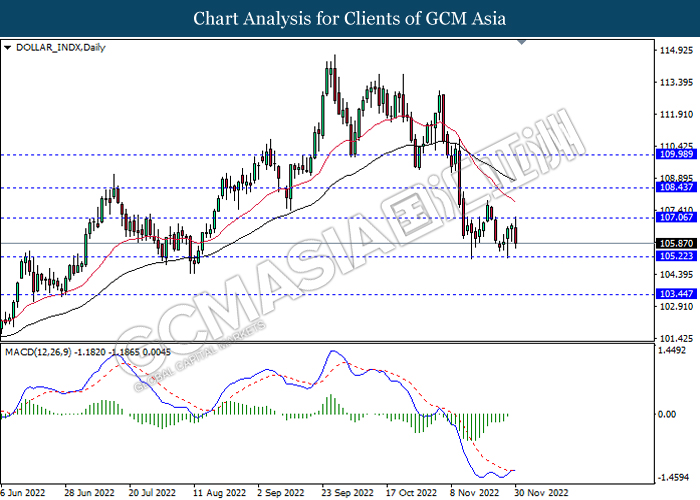

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

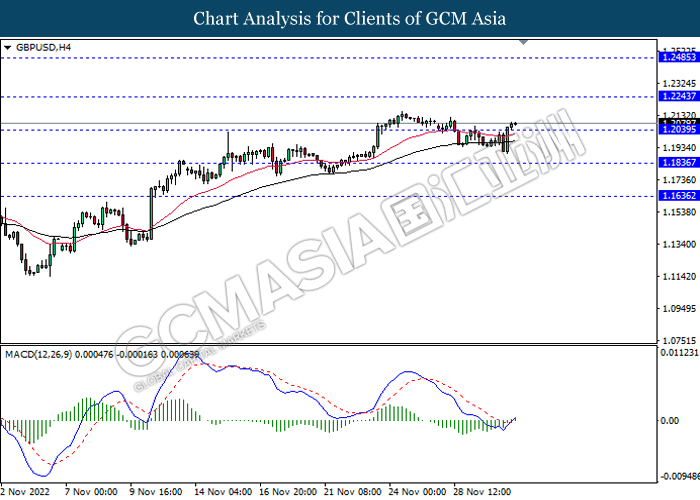

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

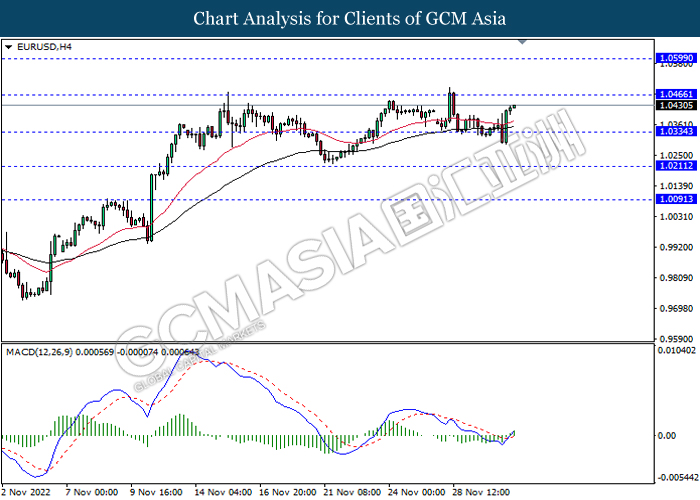

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

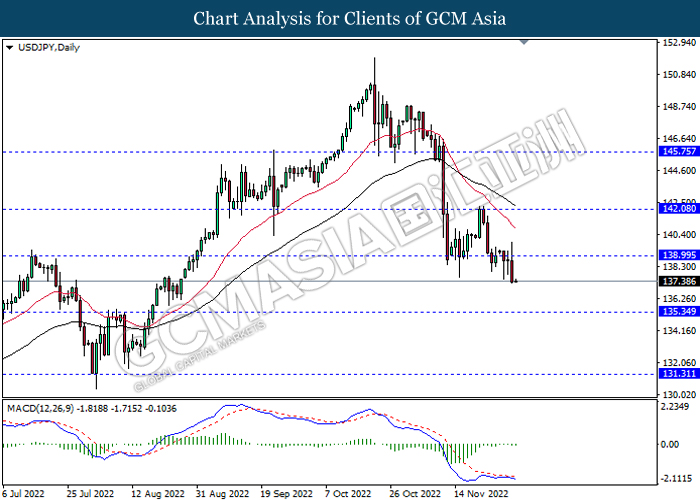

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

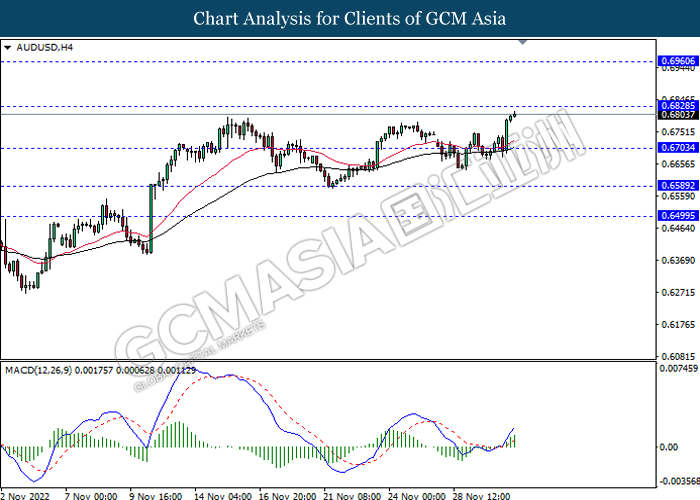

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

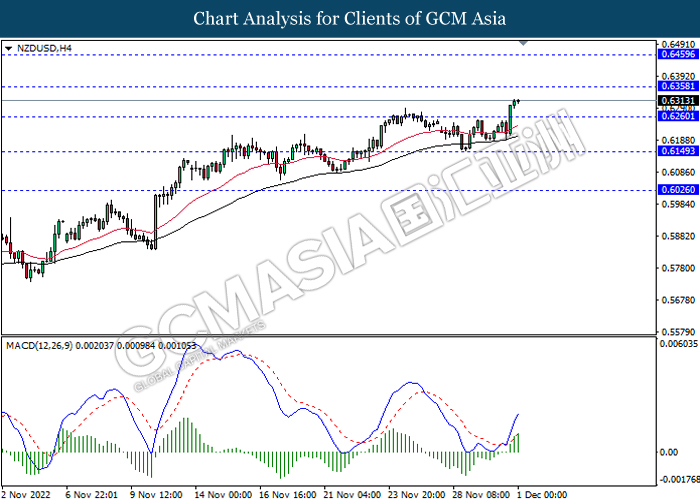

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

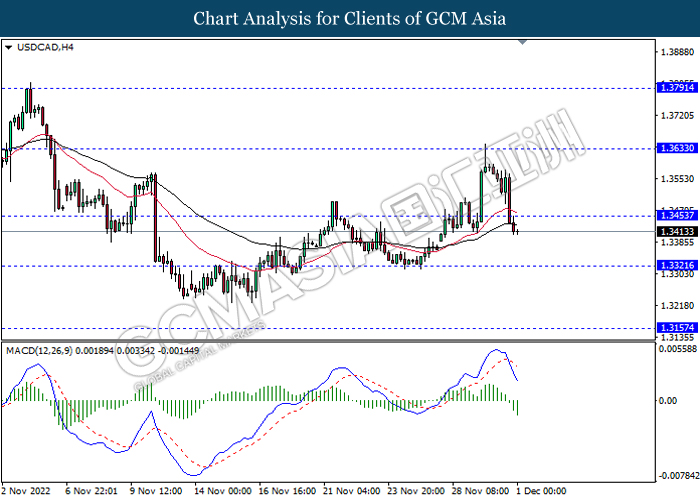

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

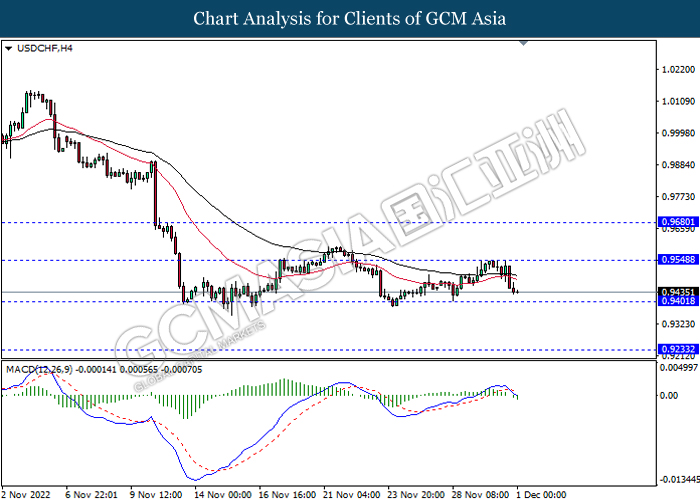

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

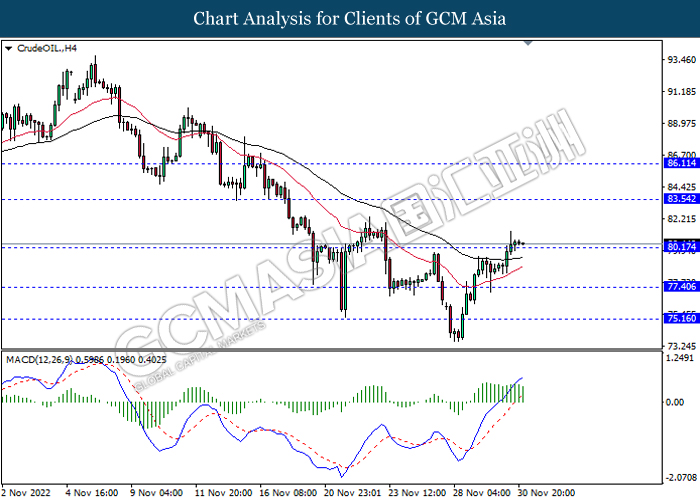

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 83.55, 86.10

Support level: 80.15, 77.40

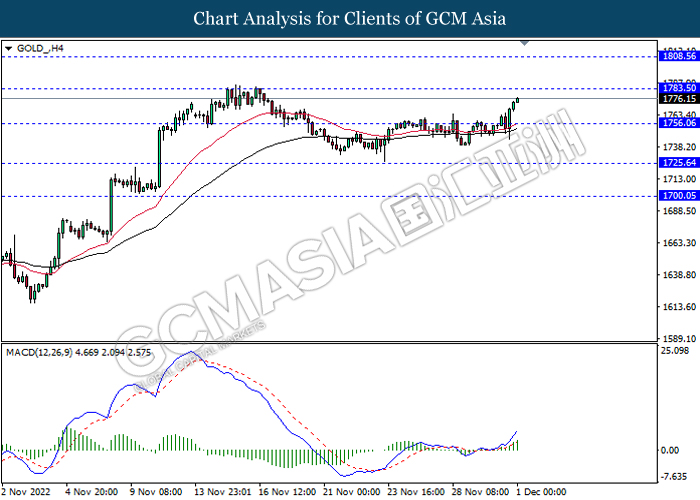

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1725.65