2 February 2023 Afternoon Session Analysis

Pound sterling rose amid US Dollar weakened.

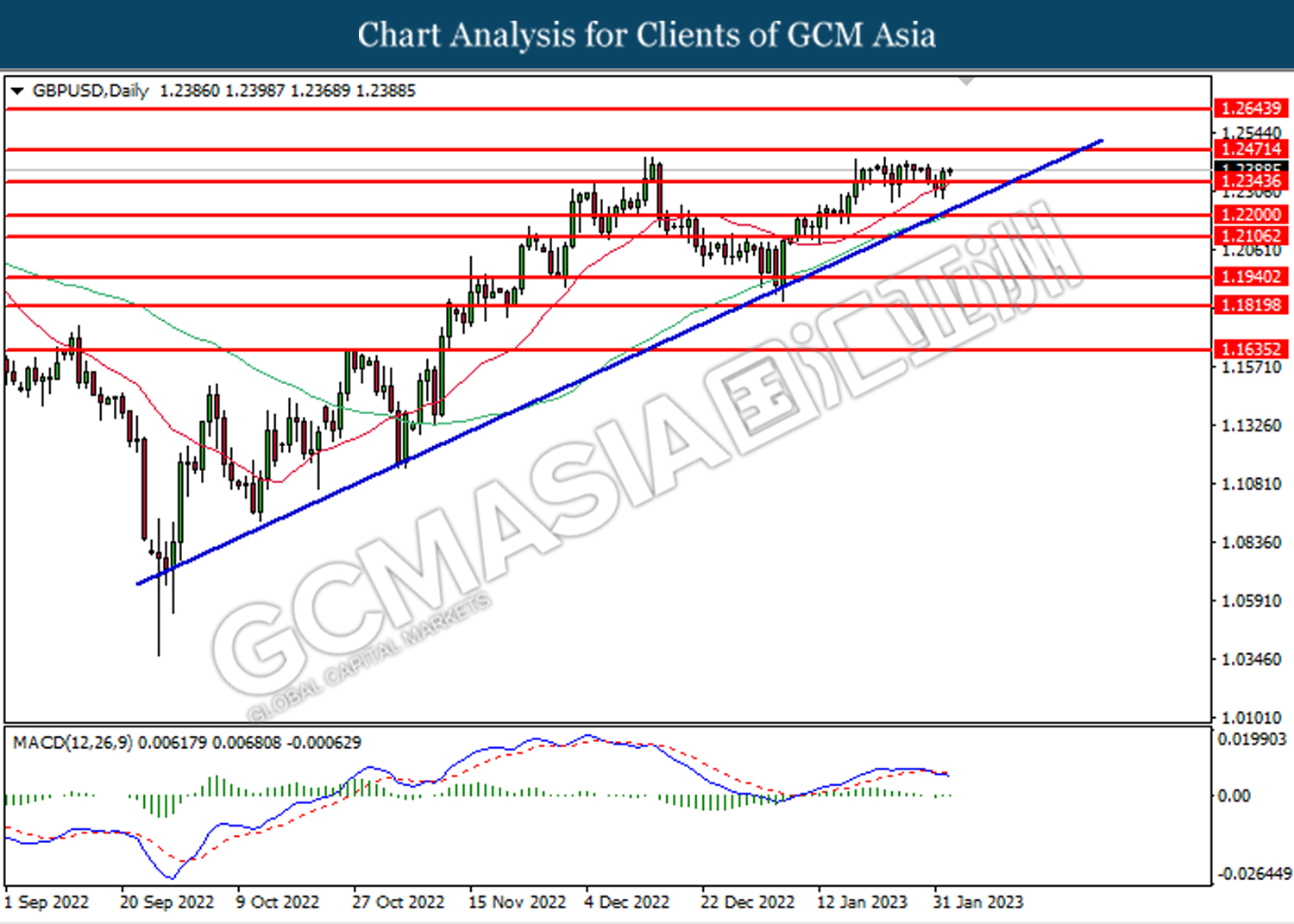

The pound sterling rose to the highest level since June 2022 level as the dollar slumped after the Fed Chairman Jerome Powell’s speech at the FOMC press conference. In the communique, Jerome Powell mentioned that US inflation has cooled, and the market started to expect that future interest rate hike decisions will come in peace or remain unchanged. As a result, the US dollar depreciated and boosted other currencies that pair with USD, such as the pound sterling. Apart from this, the pound sterling uptrend was also boosted by investors’ expectations, whereby the Bank of England (BoE) will likely have a 50-basis point rate hike in the upcoming BoE monetary policy committee meeting. According to the latest inflation data announced by the UK office for national statistics, the country’s inflation rate was at a 10.5% level in December, while the BoE target of a 2% inflation rate. An aggressive rate hike plan could affect the UK economy to enter into a recession that would weigh on the Pound. As of writing, GBP/USD appreciated 0.10% to $1.2388.

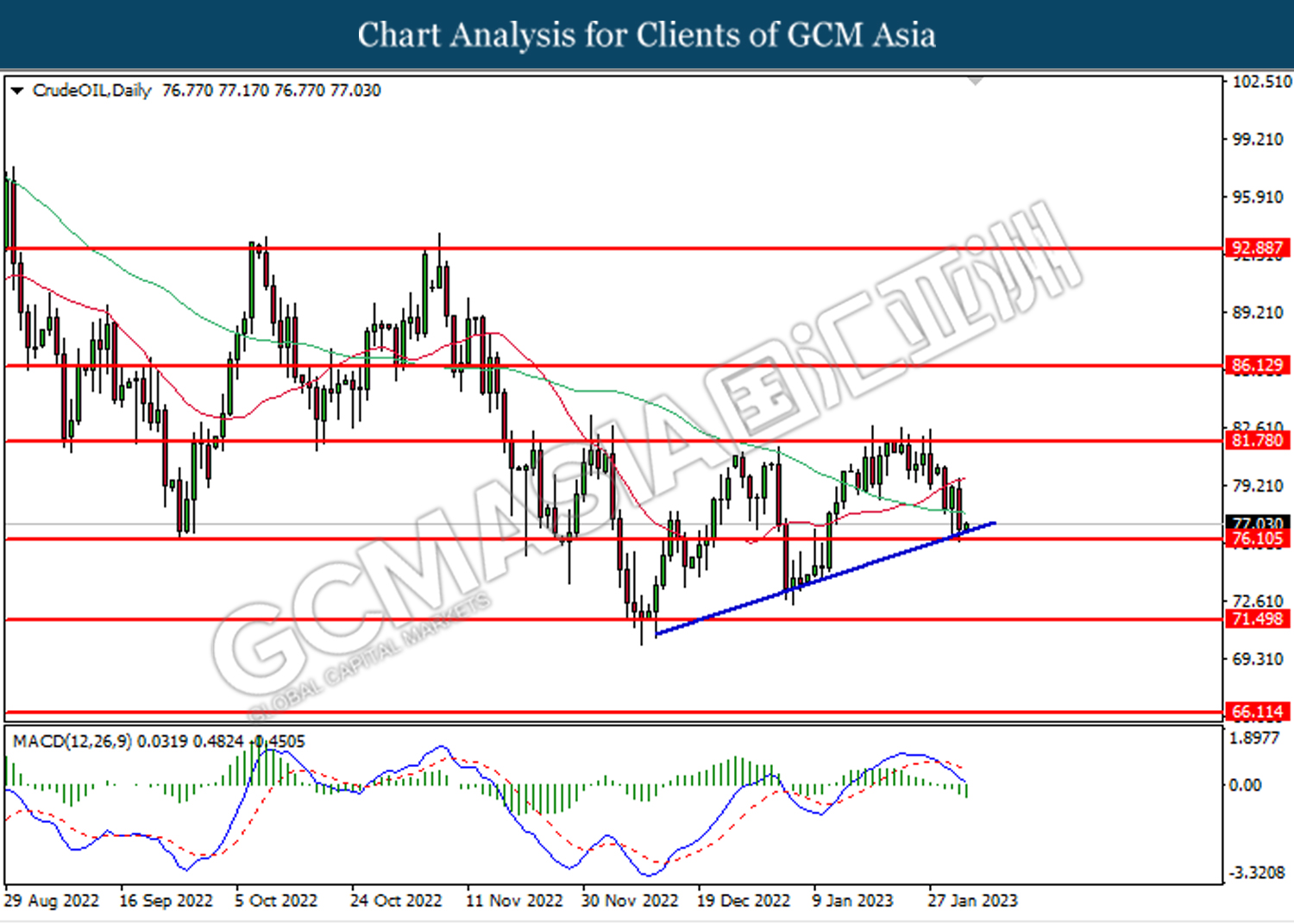

In the commodity market, the crude oil price appreciated by 0.71% to $76.95 per barrel as of writing as a weaker Greenback made the US oil price cheaper for other currency holders, and boosted the oil demand. On the other hand, the gold price raised by 1.28% to $1951.04 per troy ounce as of writing over the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | GBP – BoE Interest Rate Decision (Jan) | 3.50% | 4.00% | – |

| 21:15 | EUR – Deposit Facility Rate (Feb) | 2.00% | 2.50% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.75% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Feb) | 2.50% | 3.00% | – |

| 21:30 | USD – Initial Jobless Claims | 186K | 200K | – |

Technical Analysis

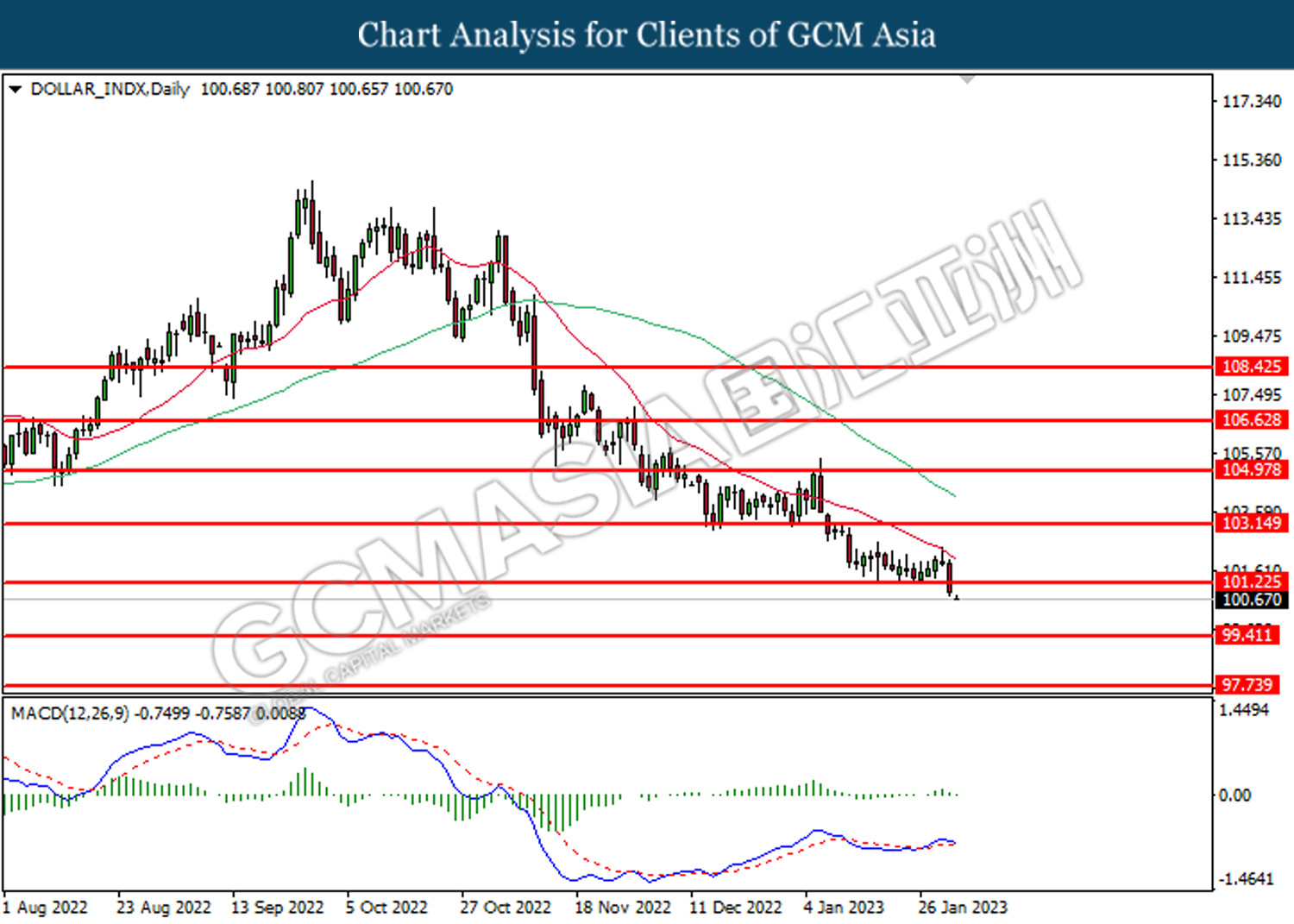

DOLLAR_INDX, Daily: Dollar was traded lower following a prior breakout below the previous support level at 101.20. MACD which illustrated diminishing bullish momentum suggested the index to extend its losses toward the support level at 99.40.

Resistance Level: 101.20, 103.15

Support Level : 99.40, 97.75

GBPUSD, Daily: GBPUSD was traded higher following a prior breakout above the previous resistance level at 1.2345. MACD which illustrated bullish bias momentum suggested the pair extend its gains toward the resistance level at 1.2470.

Resistance Level:1.2470, 1.2645

Support Level: 1.2345, 1.2200

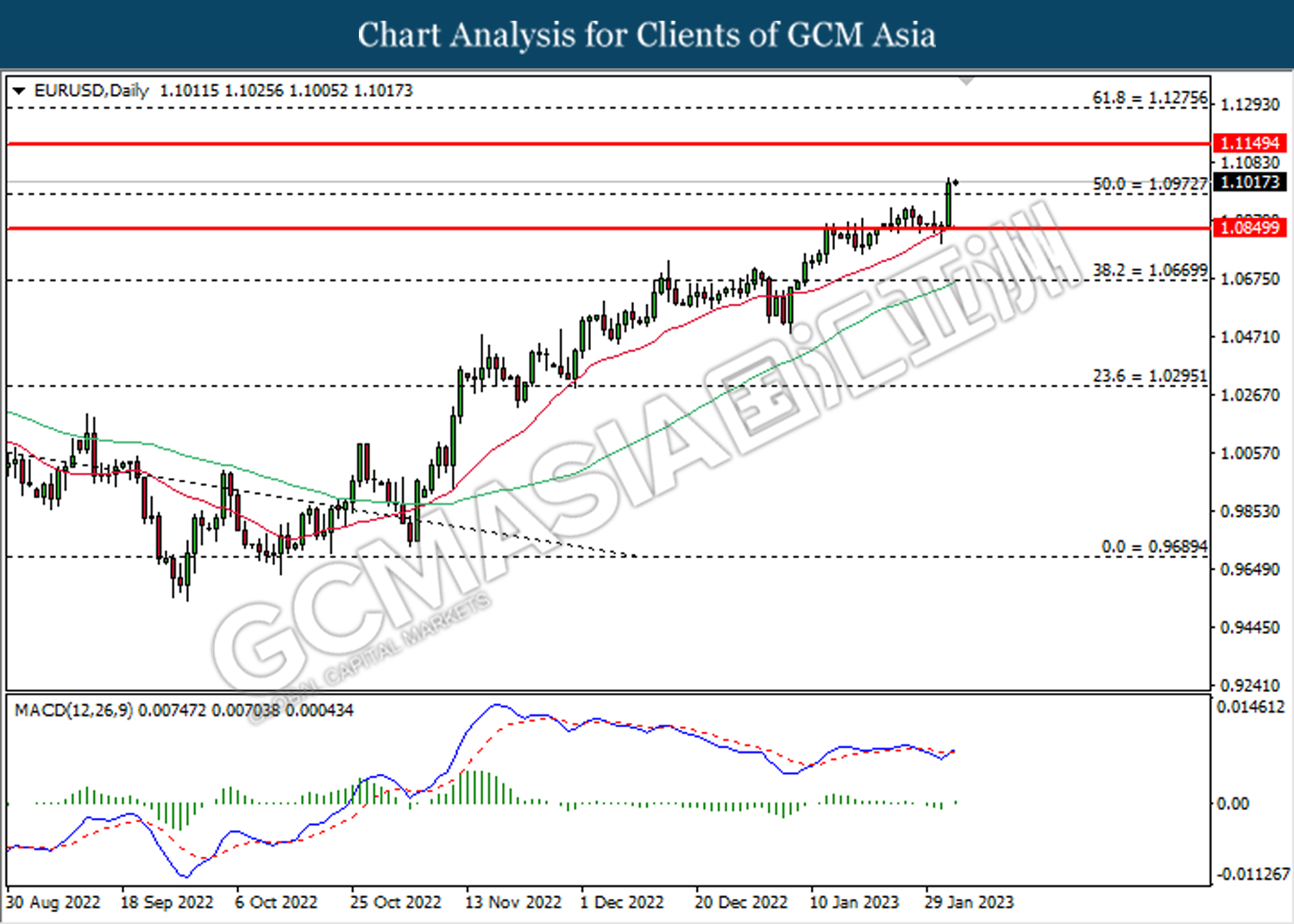

EURUSD, Daily: EURUSD was traded higher following a prior breakout above the previous resistance level at 1.0975. MACD which illustrated increasing bullish momentum suggested the pair extend it gains towards the resistance level at 1.1150.

Resistance Level: 1.1150, 1.1275

Support Level : 1.0975, 1.0850

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 128.60. MACD which illustrated diminishing bullish momentum suggested the pair extend its losses after it successfully breakout below the support at 128.60.

Resistance Level: 131.25, 134.15

Support Level : 128.60, 126.30

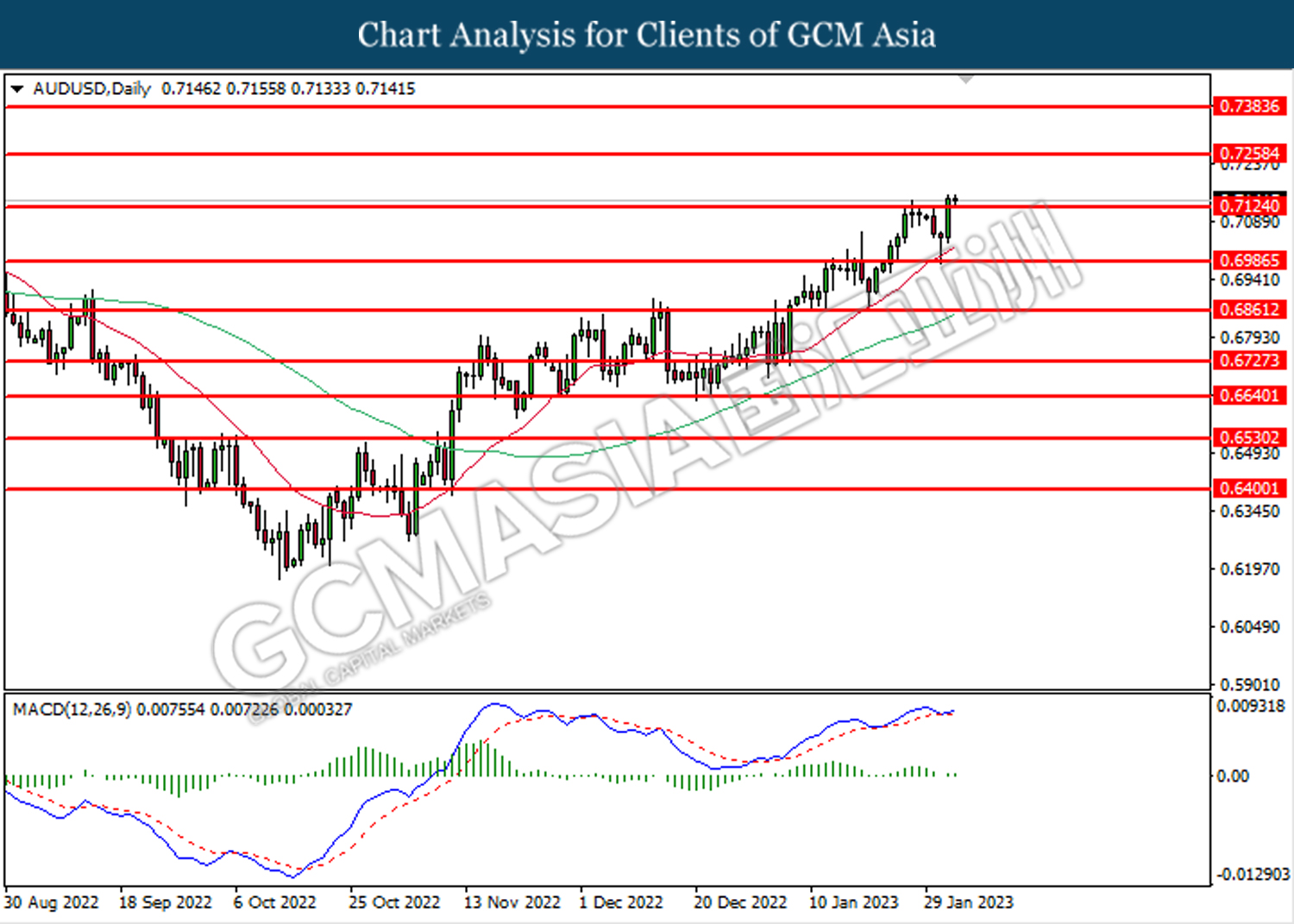

AUDUSD, Daily: AUDUSD was traded higher following a prior breakout above the previous resistance level at 0.7125. MACD which illustrated increasing bullish momentum suggested the pair extend its gains toward the resistance level at 0.7260.

Resistance Level: 0.7260, 0.7385

Support Level : 0.7125, 0.6985

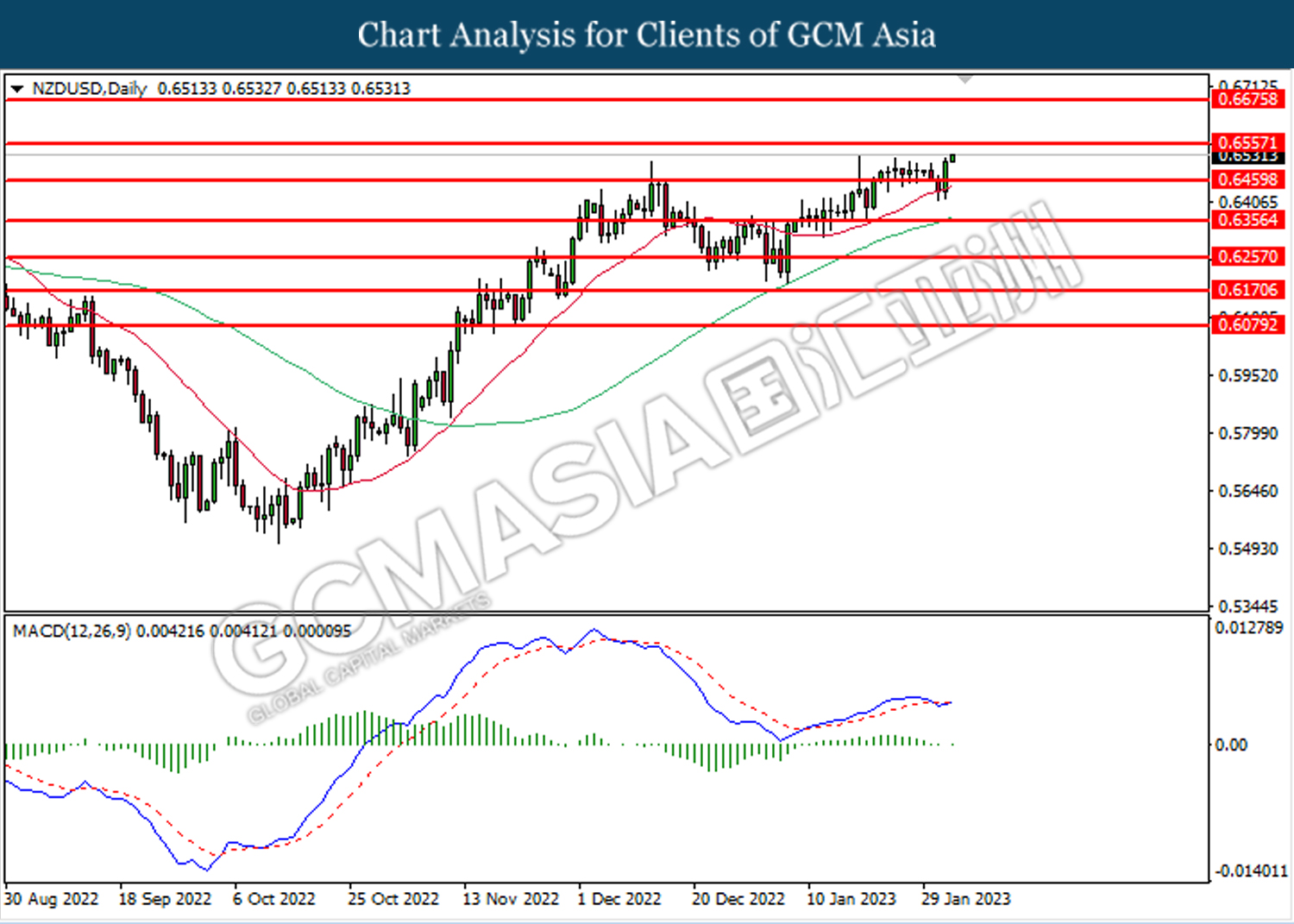

NZDUSD, Daily: NZDUSD was traded higher following a prior breakout above the previous resistance level at 0.6460. MACD which illustrated bullish bias momentum suggested the pair to extend its gains toward the resistance level at 0.6555.

Resistance Level: 0.6555, 0.6675

Support Level : 0.6460, 0.6355

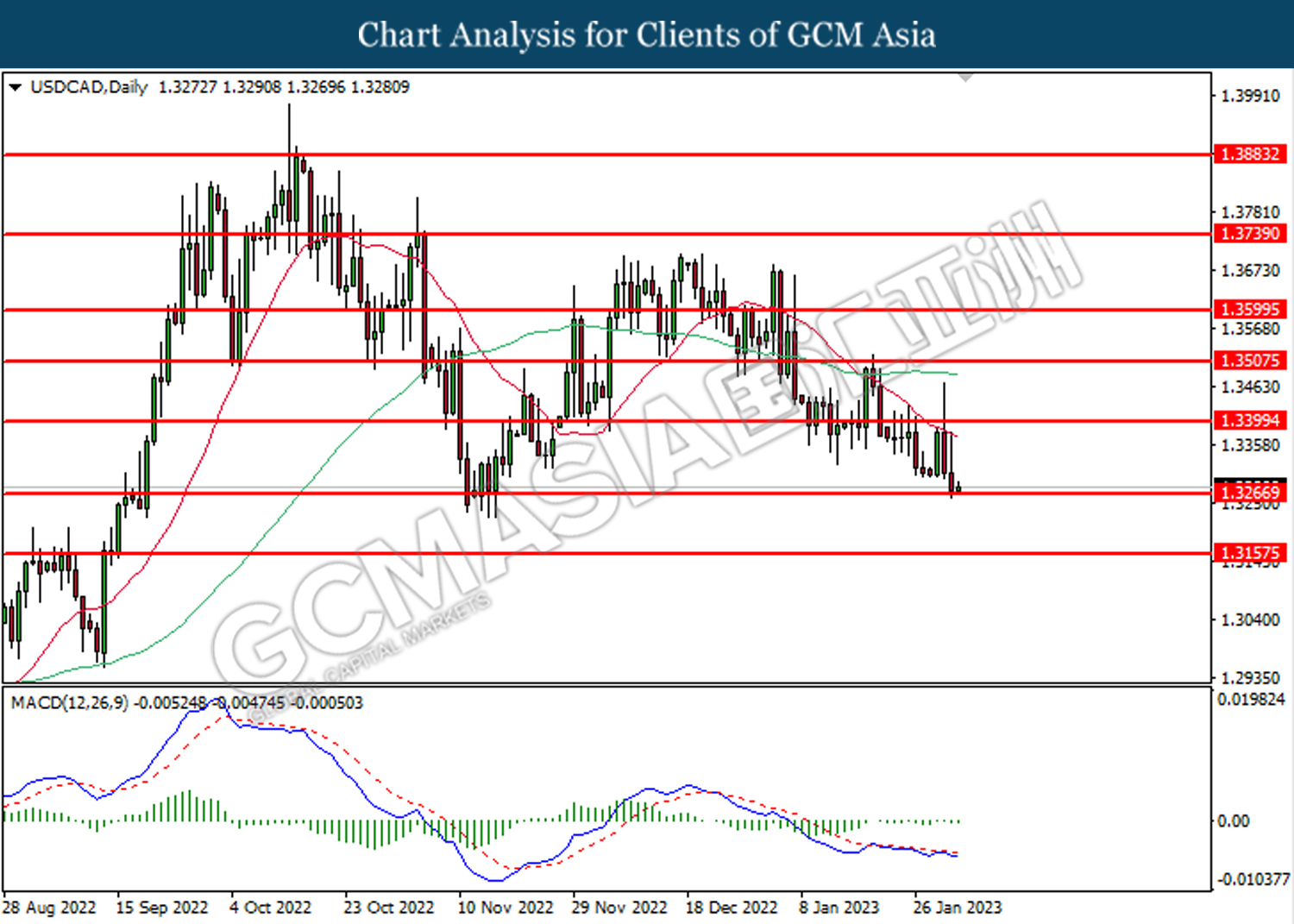

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3265. MACD which illustrated bearish bias momentum suggested the pair extend its losses after it successfully breakout below the support level.

Resistance Level: 1.3400, 1.3505

Support Level : 1.3265, 1.3155

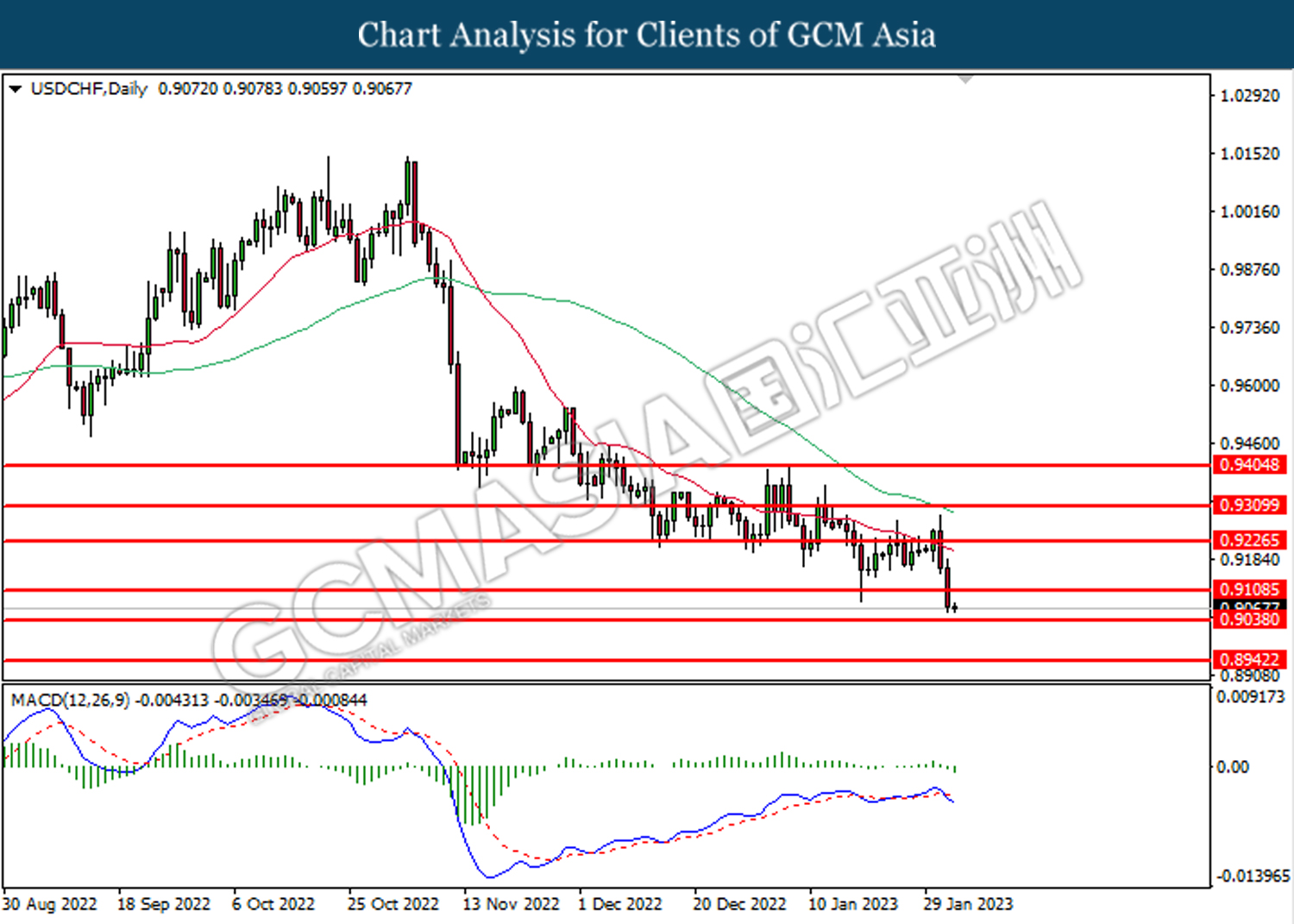

USDCHF, Daily: USDCHF was traded lower following a prior breakout below the previous support level at 0.9110. MACD which illustrated bearish bias momentum suggested the pair will extend its losses toward the support level at 0.9040.

Resistance Level: 0.9110, 0.9225

Support Level : 0.9040, 0.8940

CrudeOIL, Daily: Crude oil was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggested the commodity will extend its losses after it successfully breakout below the trendline.

Resistance Level: 81.80, 86.15

Support Level : 76.10, 71.50

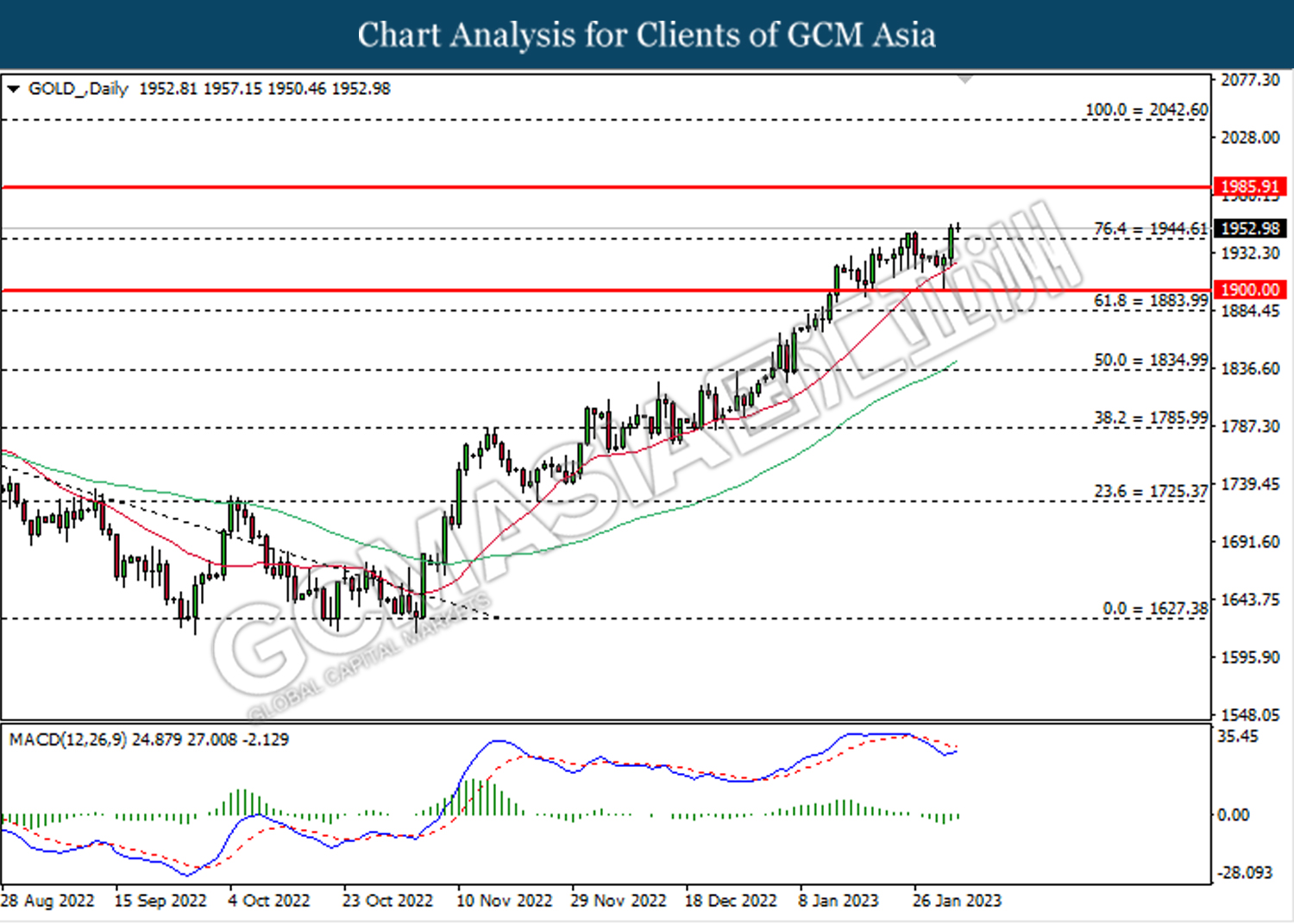

GOLD, Daily: Gold was traded higher following a prior breakout above the previous resistance level at 1944.60. MACD which illustrated diminishing bearish momentum suggested the commodity will extend its gains towards the resistance level at 1985.90.

Resistance Level: 1985.90, 2042.60

Support Level : 1944.60, 1900.00