2 February 2023 Morning Session Analysis

US Dollar dived following the Fed’s smaller hikes.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday after Fed’s Chairman acknowledged that the inflationary risk was easing. Earlier of the day, the US central bank decided to raise its interest rate by 25 basis point to 4.75%, which was the second consecutive lower rate hike after the four 75 basis point hikes in a row. In the Press Conference, Federal Reserve Chair Jerome Powell claimed that there was a significant effects in bringing down inflation pressure, whereby hinting that Fed would likely to step back from its aggressive contractionary monetary policy in the March meeting. Though, it was noteworthy that the Fed might continue to increase its rates as they were committed to restore price stability, according to the speech of Fed in Press Conference. Thus, the likelihood of another rate hike might not be excluded. On the economic data front, a series of downbeat economic data has spurred further bearish momentum toward US Dollar. The data such as US ADP Nonfarm Employment Change and US ISM Manufacturing Purchasing Managers Index (PMI) has disappointed market participants, which highlighting the side effects that driven by prior aggressive rate hike by Fed. As of writing, the Dollar Index dropped by 0.94% to 100.95.

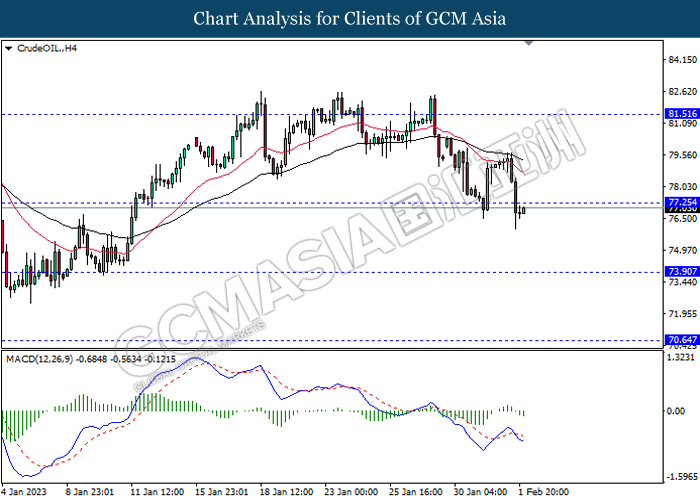

In the commodity market, the crude oil price appreciated by 0.79% to $77.04 per barrel as of writing following the smaller rate hike by Fed has offset the market concern upon recession. On the other hand, the gold price raised by 1.28% to $1951.04 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | GBP – BoE Interest Rate Decision (Jan) | 3.50% | 4.00% | – |

| 21:15 | EUR – Deposit Facility Rate (Feb) | 2.00% | 2.50% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.75% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Feb) | 2.50% | 3.00% | – |

| 21:30 | USD – Initial Jobless Claims | 186K | 200K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its losses.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

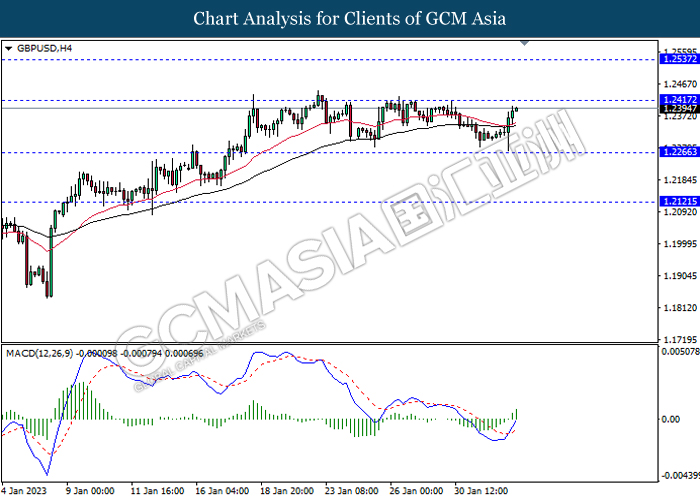

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2415, 1.2535

Support level: 1.2265, 1.2120

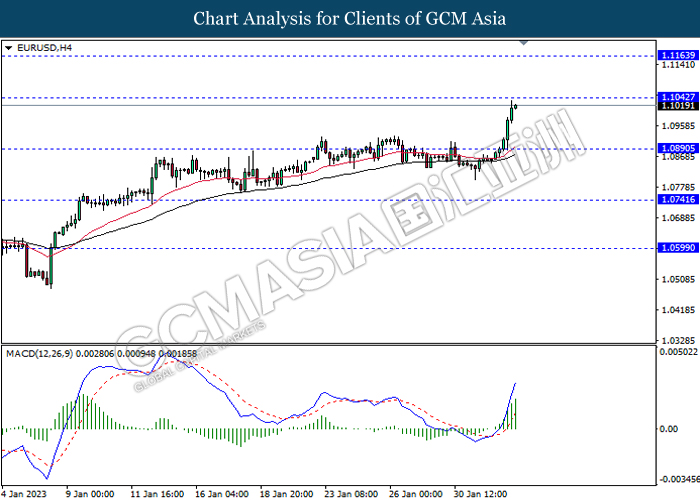

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1040, 1.1165

Support level: 1.0890, 1.0740

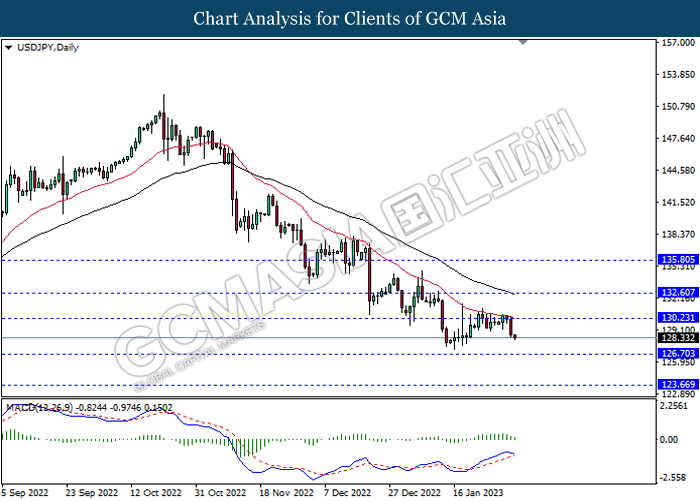

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 130.35, 132.60

Support level: 126.70, 123.65

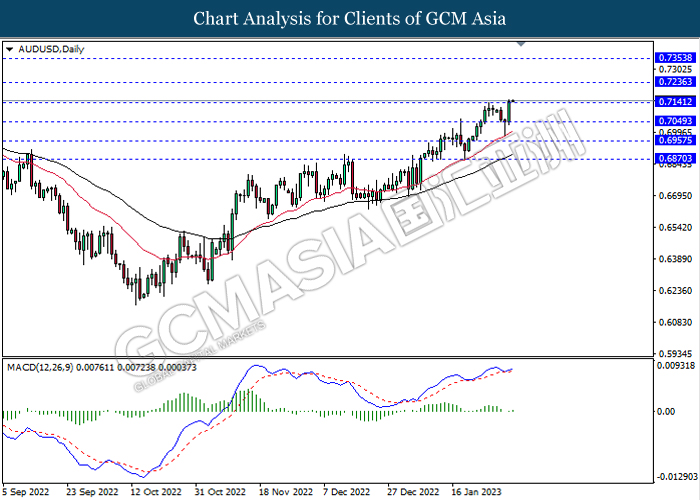

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7235, 0.7355

Support level: 0.7140, 0.7050

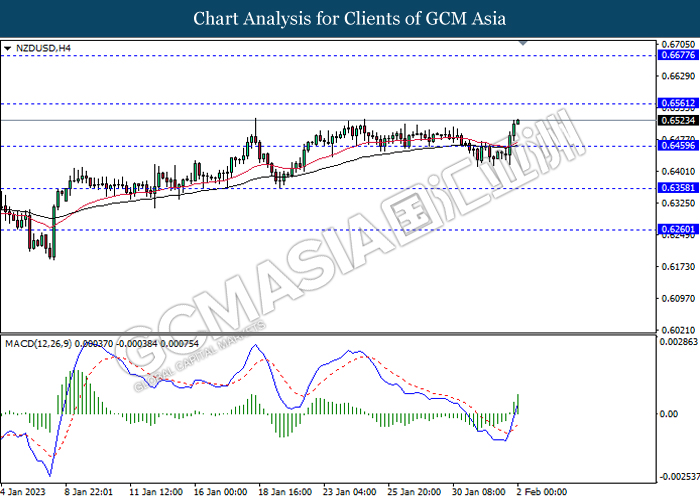

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6560, 0.6675

Support level: 0.6460, 0.6360

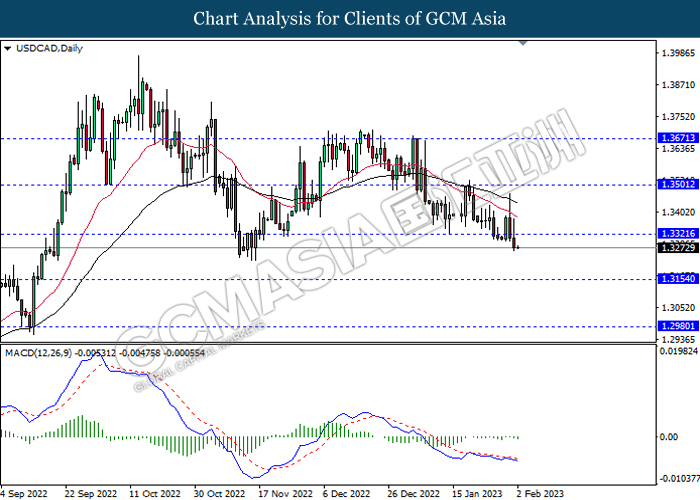

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3320, 1.3500

Support level: 1.3155, 1.2980

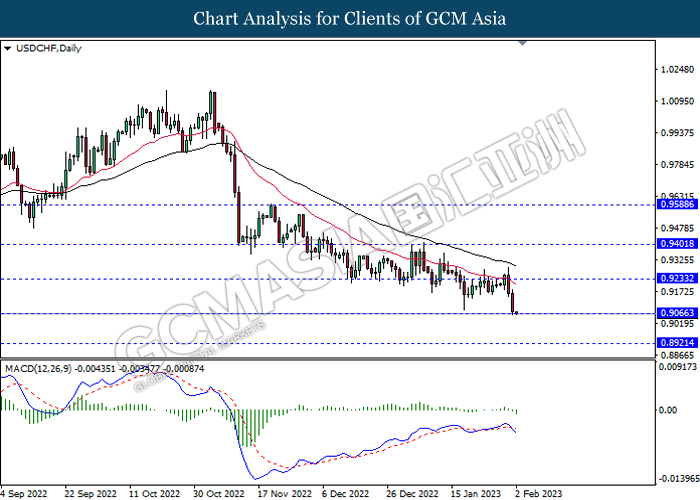

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

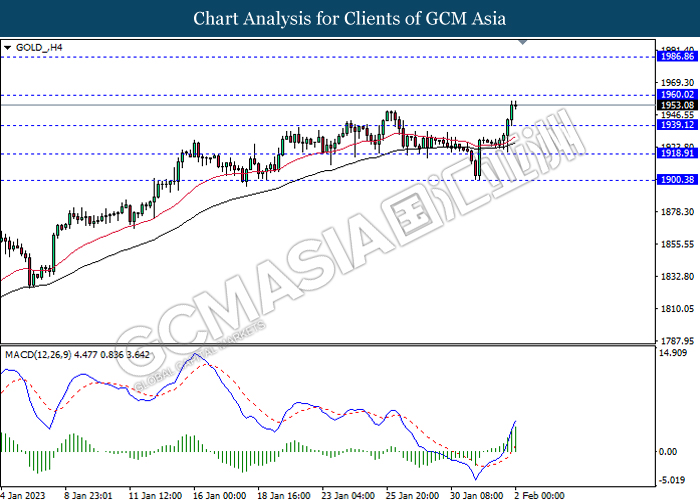

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1960.00, 1986.85

Support level: 1939.10, 1918.90