02 June 2023 Afternoon Session Analysis

The EURUSD soars despite eurozone inflation dipped.

The pair of the Euro against the dollar index soared despite eurozone inflation showing some sign of price pressure has eased. The Eurozone Consumer Price Index (CPI), data announced by Eurostat yesterday, was eased from 7.0% to 6.1%, slipped more than market expectations for 6.3%. While the Core goods price index which measures excluding food, energy, alcohol and tobacco eased to 5.3% from 5.6%, lower than the market expectation of 5.5%. CPI and core CPI data prompted the central bank to pause it’s tightening action for the upcoming monetary policy decision, but central bank governor Christine Lagarde followed with her hawkish statement. In her speech, Lagarde mentioned that inflation in the eurozone was too high and would last for too long, so the European Central Bank decided to further tighten monetary policy until inflation returned to the European Central Bank’s 2% annual target range. On the other hand, the greenback traded under sell-off pressure after the Fed’s member, Patrick Harker recommends a rate paused at the next meeting. With such a backdrop, the dollar weakened and support the Euro. As of writing, the EUR/USD edged up by 0.06% to 1.0768.

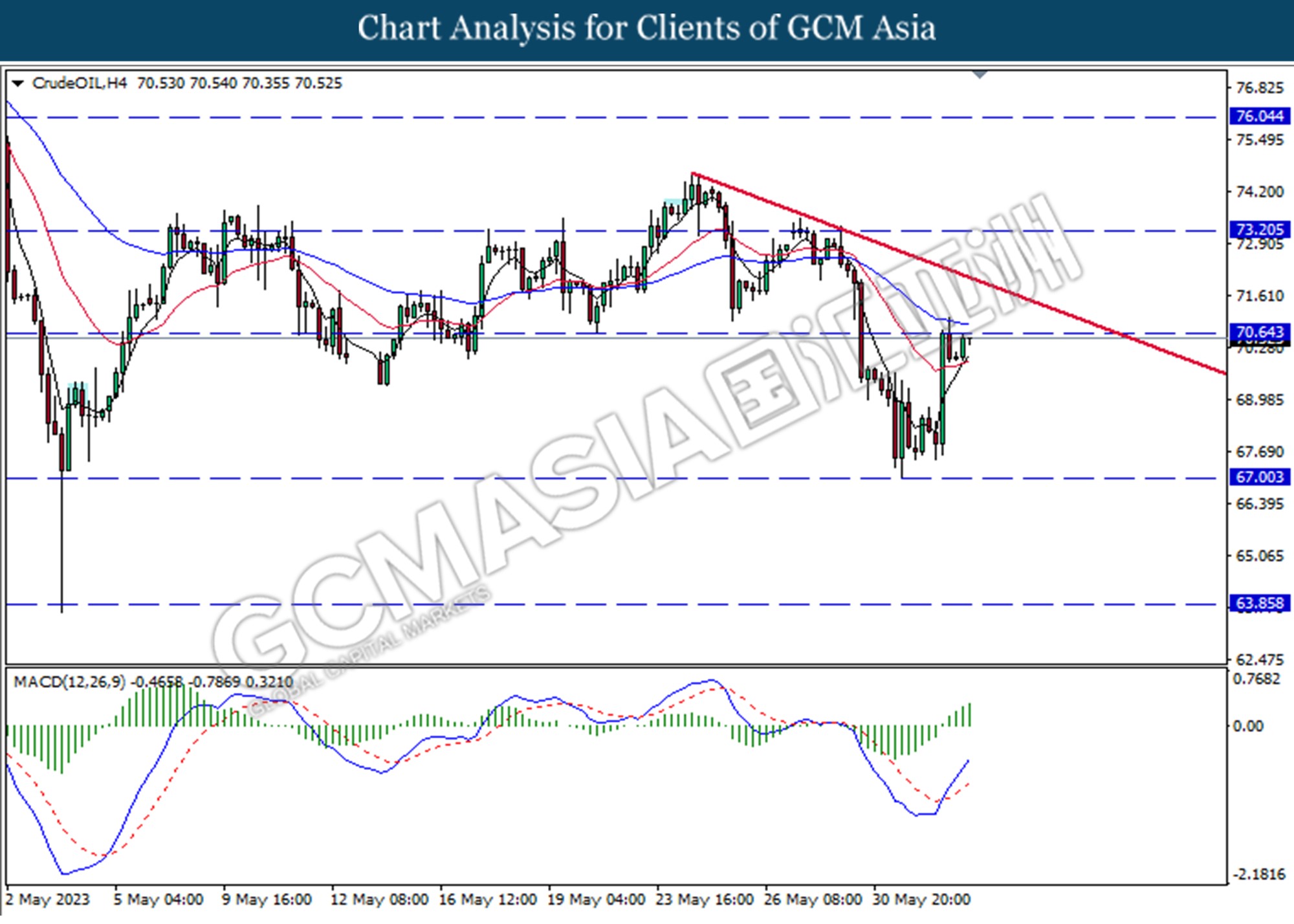

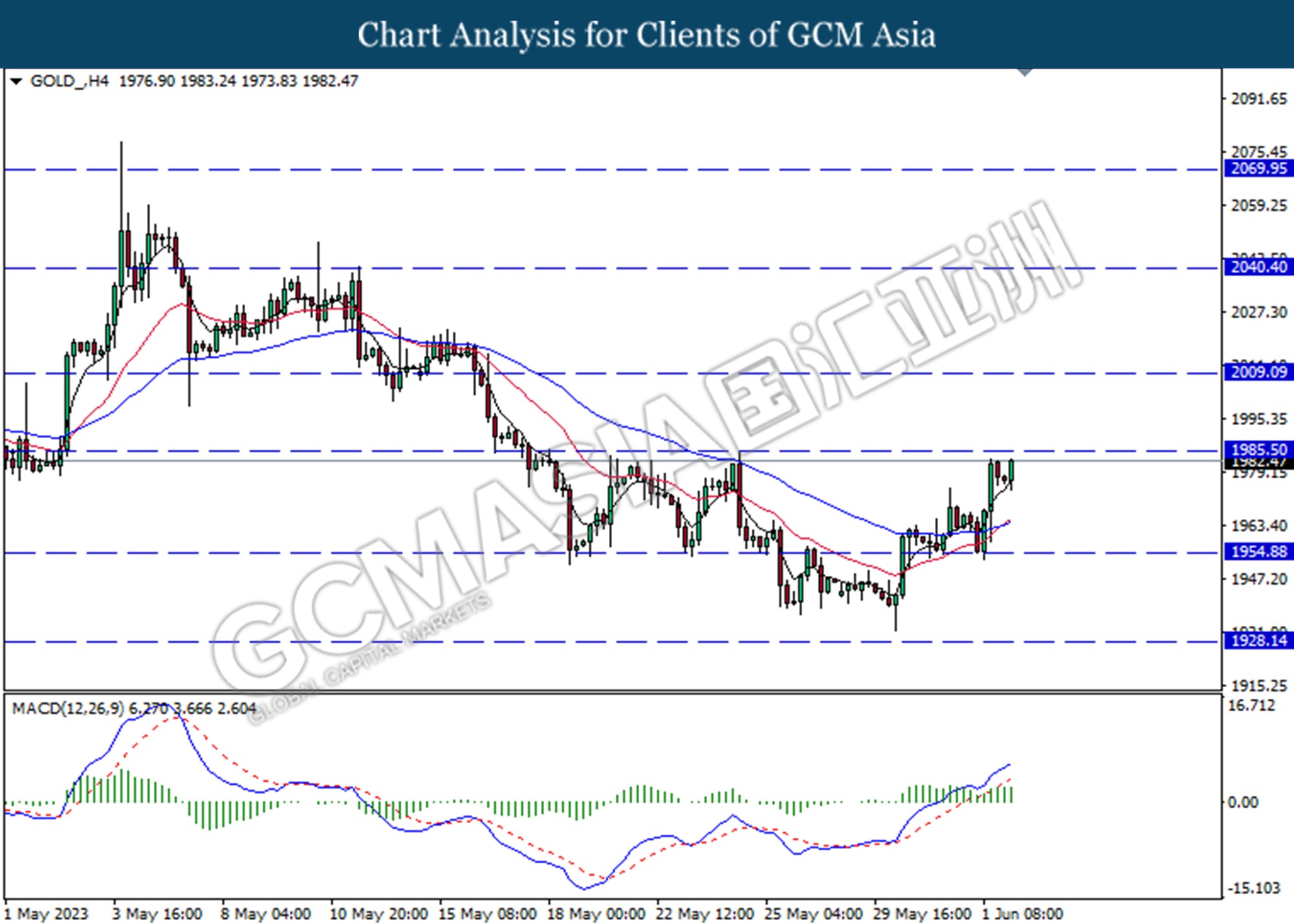

In the commodities market, crude oil prices were traded up by 0.66% to $70.56 per barrel as bullish sentiment following the Congress approves the US debt ceiling bill. Besides, gold prices lifted up by 0.26% to $1982.61 per troy ounce as investors eyed non-farm payroll data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (May) | 0.5% | 0.4% | – |

| 20:30 | USD – Nonfarm Payrolls (May) | 253K | 180K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.4% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the breaks below the previous support level at 103.75. MACD which illustrated bearish momentum suggests the index extended its losses toward the support level at 102.85.

Resistance level: 103.75, 104.45

Support level: 102.85, 102.10

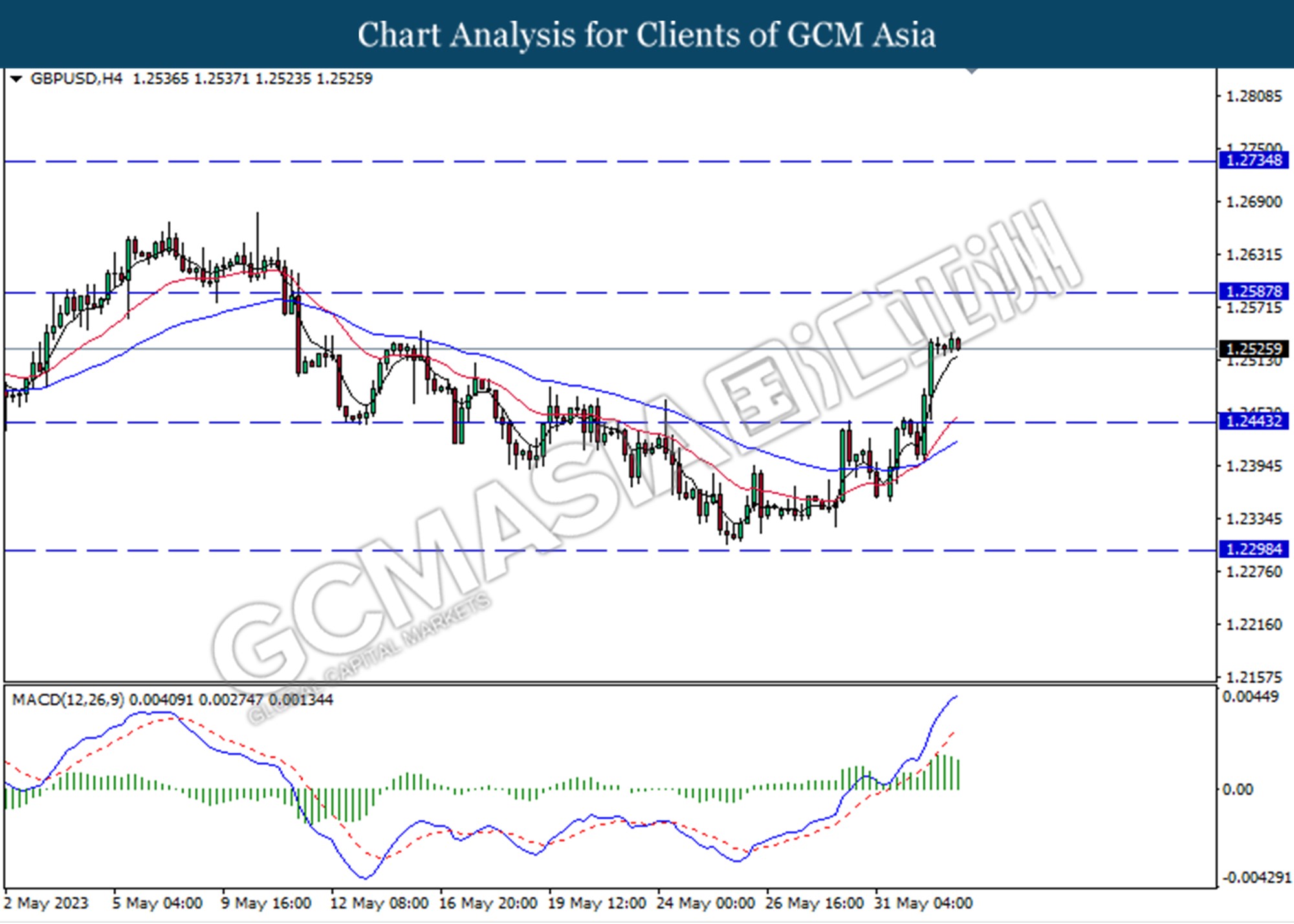

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2445. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

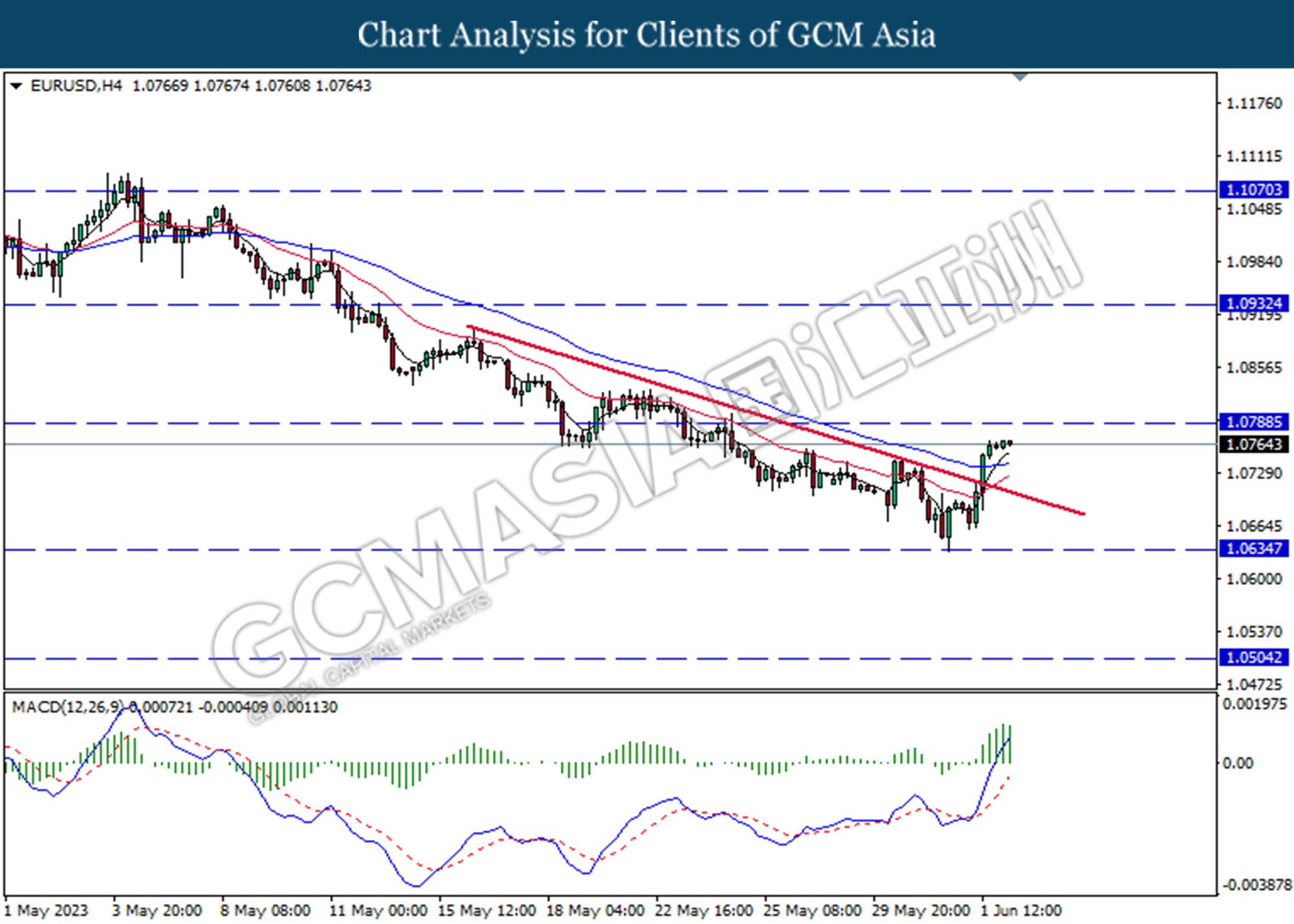

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

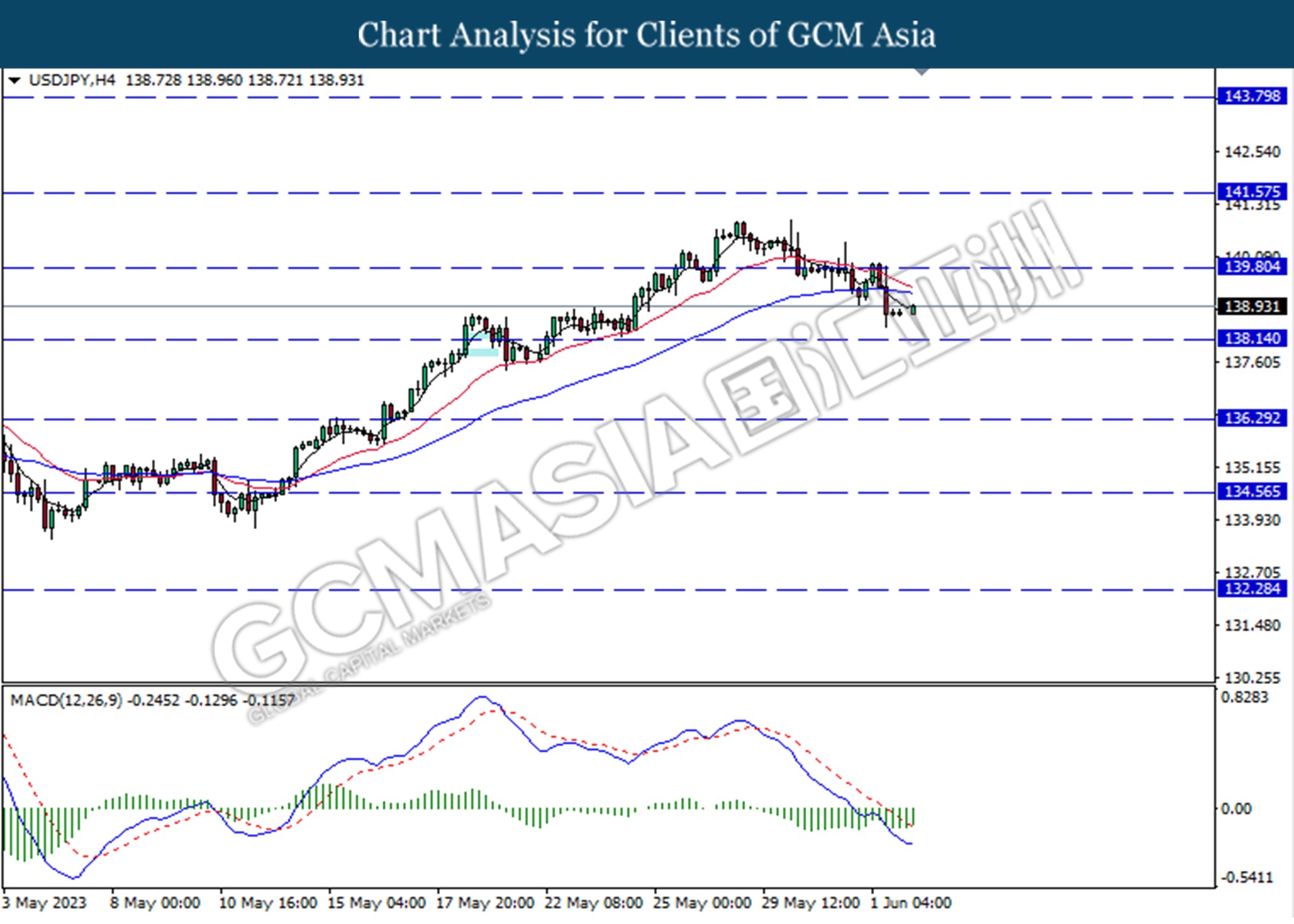

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 139.80. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 138.15.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

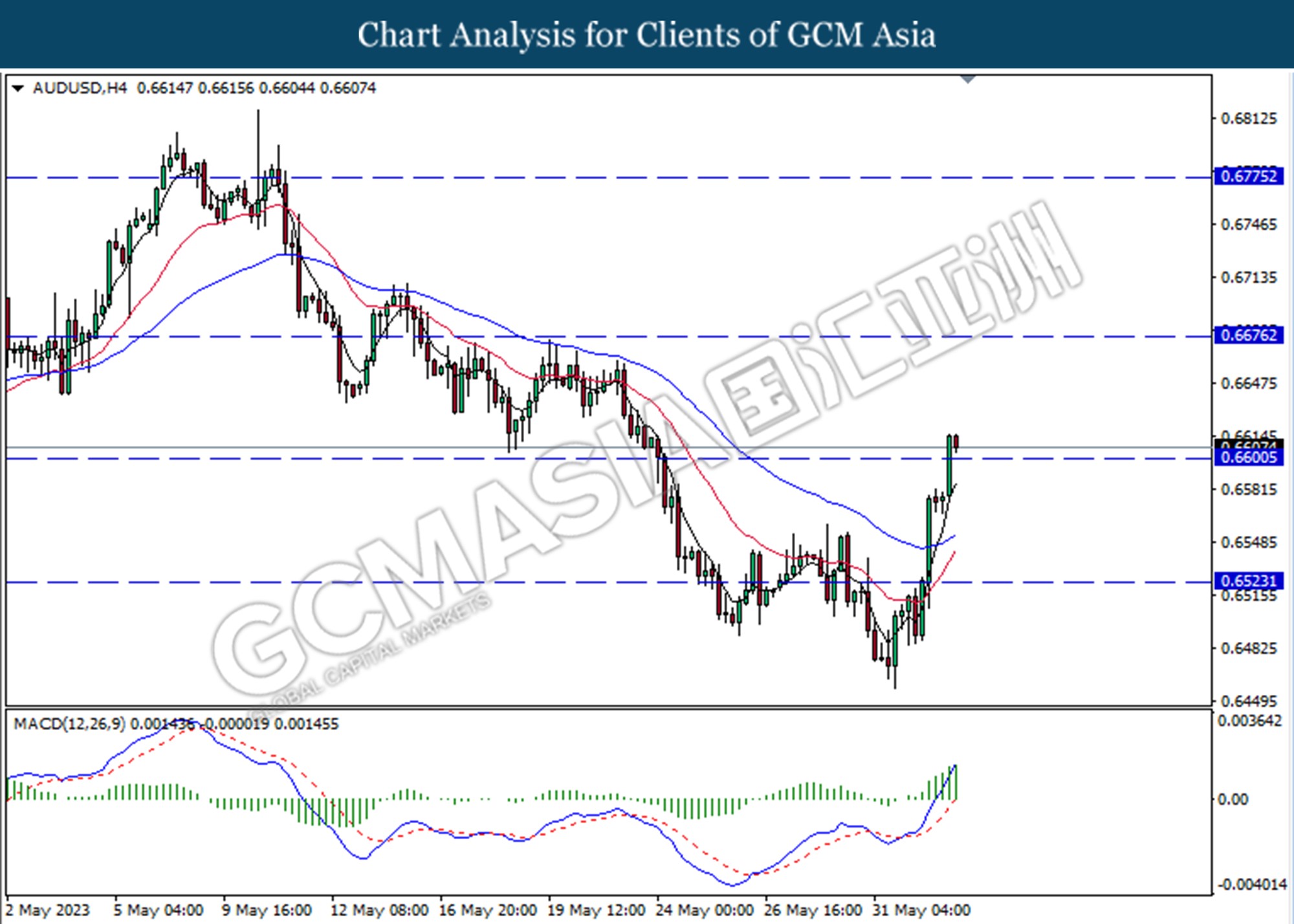

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above the previous resistance level at 0.6600. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

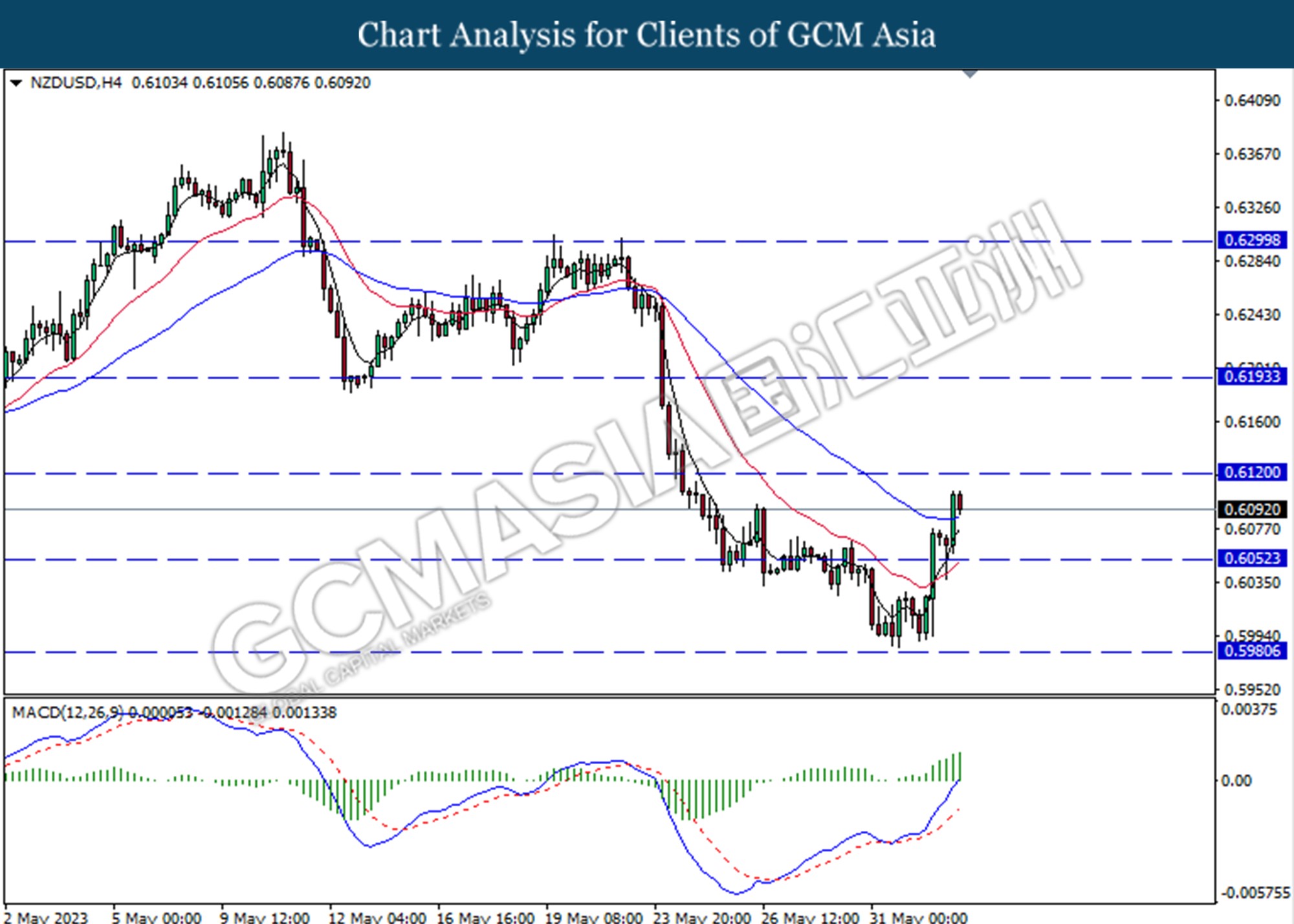

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 0.6120

Resistance level: 0.6120, 0.6195

Support level: 0.6050, 0.5980

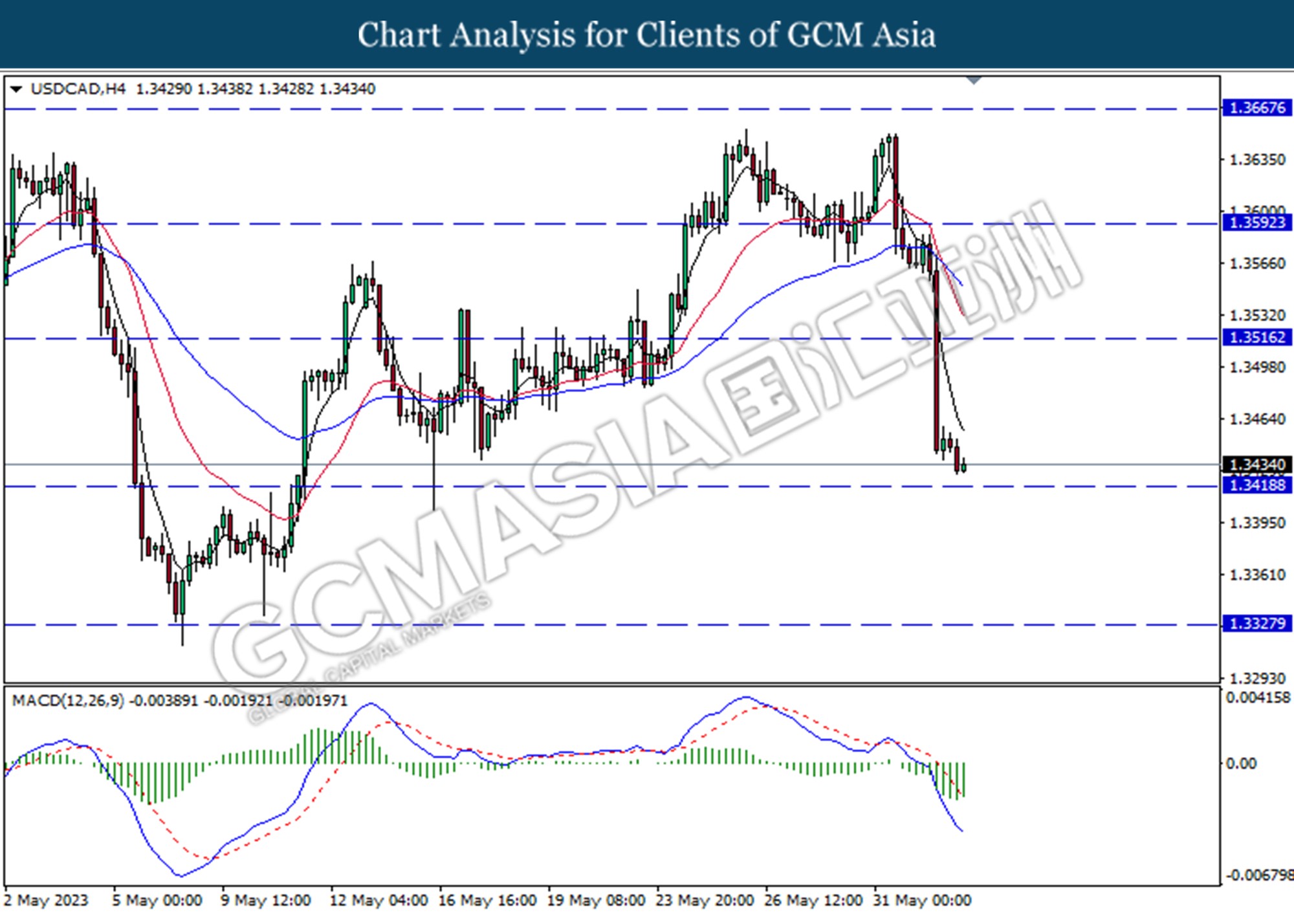

USDCAD, H4: USDCAD was traded following the prior breaks below the previous support level at 1.3515. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.3515, 1.3590

Support level: 1.3420, 1.3330

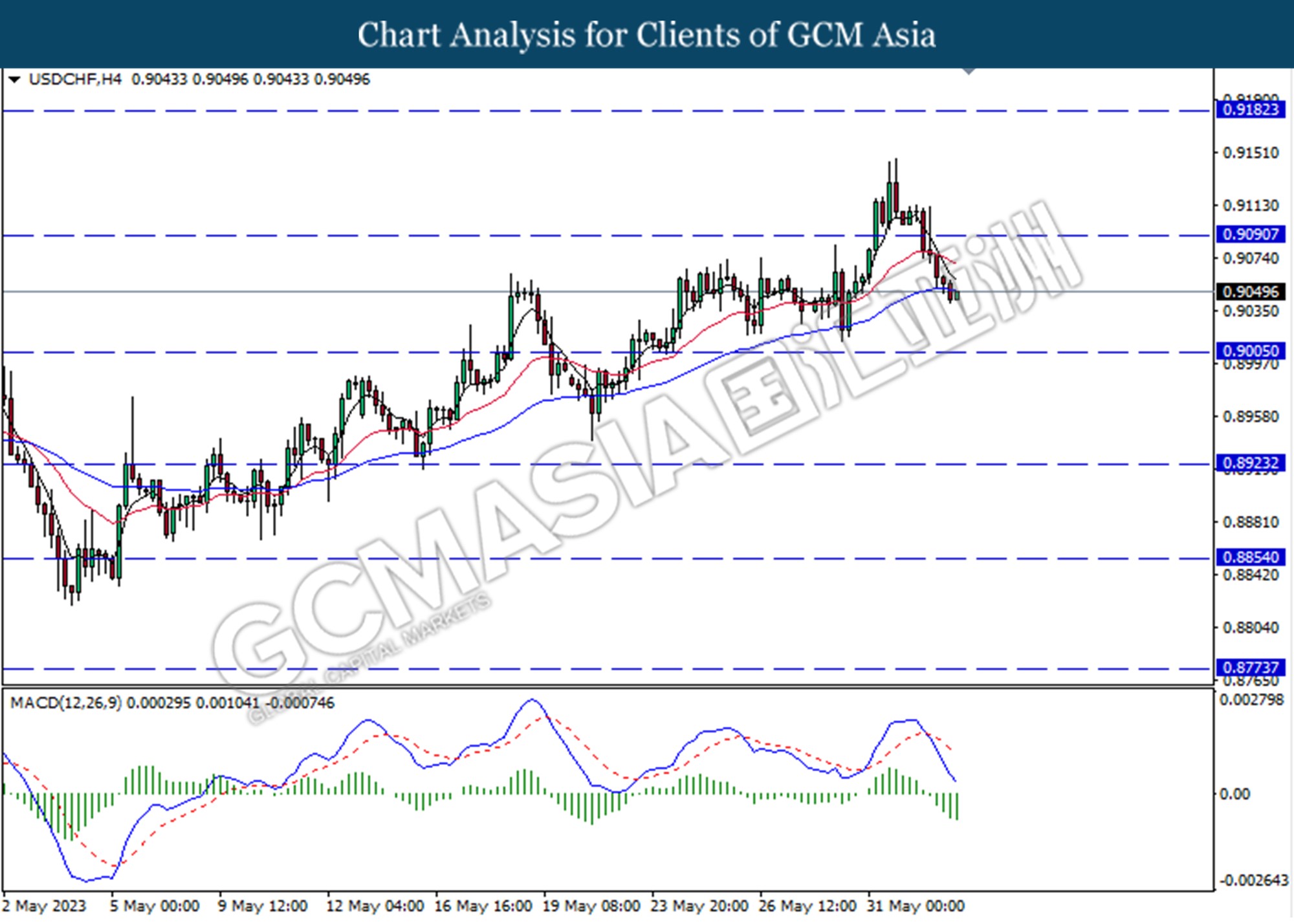

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.9090. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

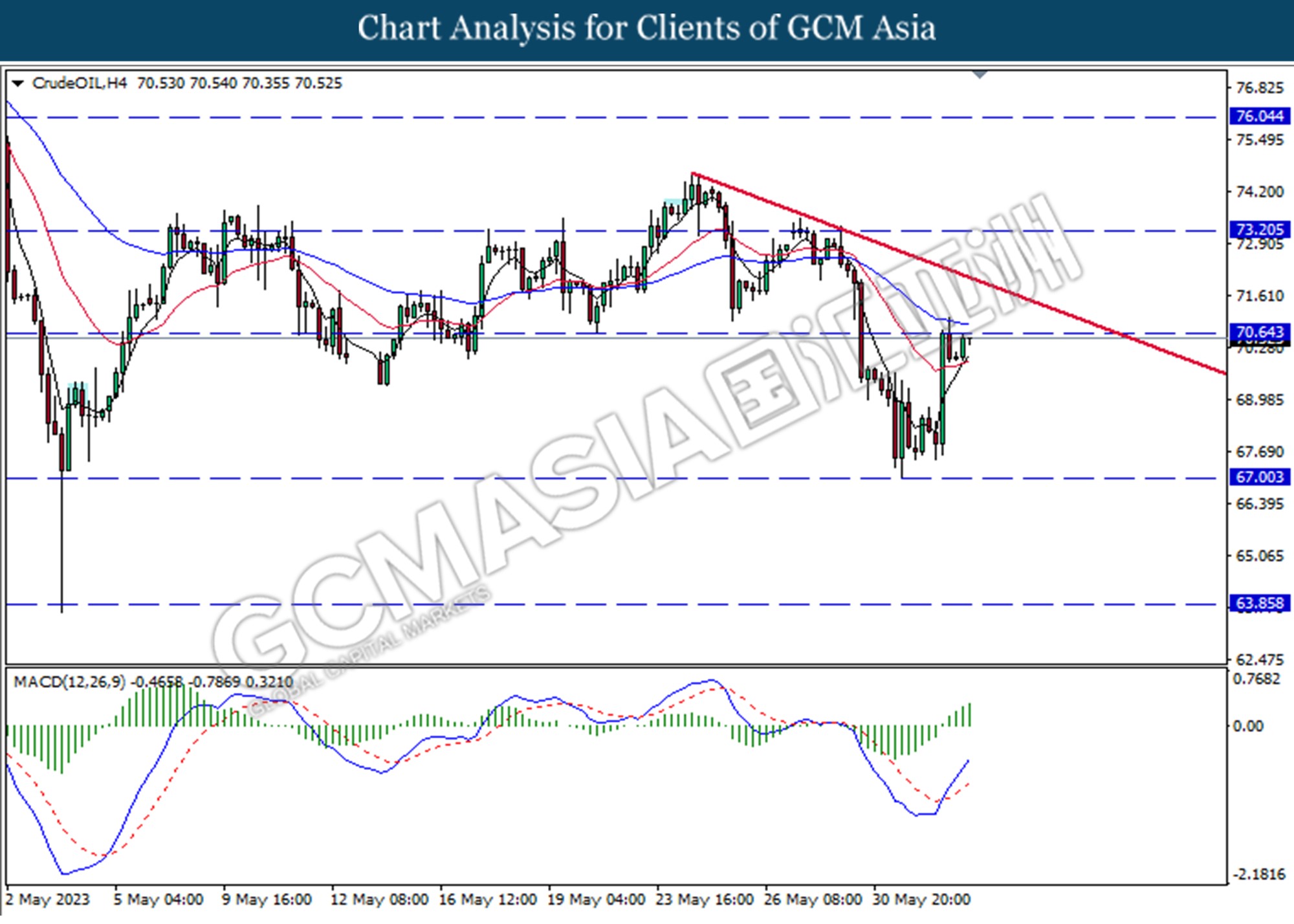

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1985.50

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15