02 June 2023 Morning Session Analysis

The dollar plummeted as Fed will likely skip the rate hike in the June meeting.

The dollar index, which was traded against a basket of six major currencies, failed to extend its rally yesterday as the market sentiment continued to be hammered by the Fed’s dovish statement. Yesterday, the Philadelphia Federal Reserve President Patrick Harker said, “It is the time to hit the stop button for at least one meeting.” The statement was followed by the justification that the current monetary policy will likely do its work in order to cool down inflation back to its long-term target in a timely manner. However, he also reiterated that the uncertainty in the US economy is high; further economic data will be taken into consideration before determining to have an extra tightening step or not. As the investor’s expectation of a further rate hike started to fade, yesterday’s upbeat data failed to ignite the dollar market. According to Automatic Data Processing (ADP), the US Nonfarm Employment Change dropped from the prior reading of 291K to 278K in May, but far higher than the market consensus at 170K. At the same time, the Department of Labor in the US also reported the Initial Jobless Claims data at 232K, lower than the forecast of 235K. These positive job data provided well-enough room to Fed for further rate hike if needed. As of writing, the dollar index edged down -0.73% to 103.55.

In the commodities market, crude oil prices skyrocketed by 4.85% to $70.90 per barrel as the weakness of the US dollar benefited the non-US oil buyer in terms of their cost of purchasing. Besides, gold prices were up by 0.20% to $1977.30 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (May) | 0.5% | 0.4% | – |

| 20:30 | USD – Nonfarm Payrolls (May) | 253K | 180K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.4% | 3.5% | – |

Technical Analysis

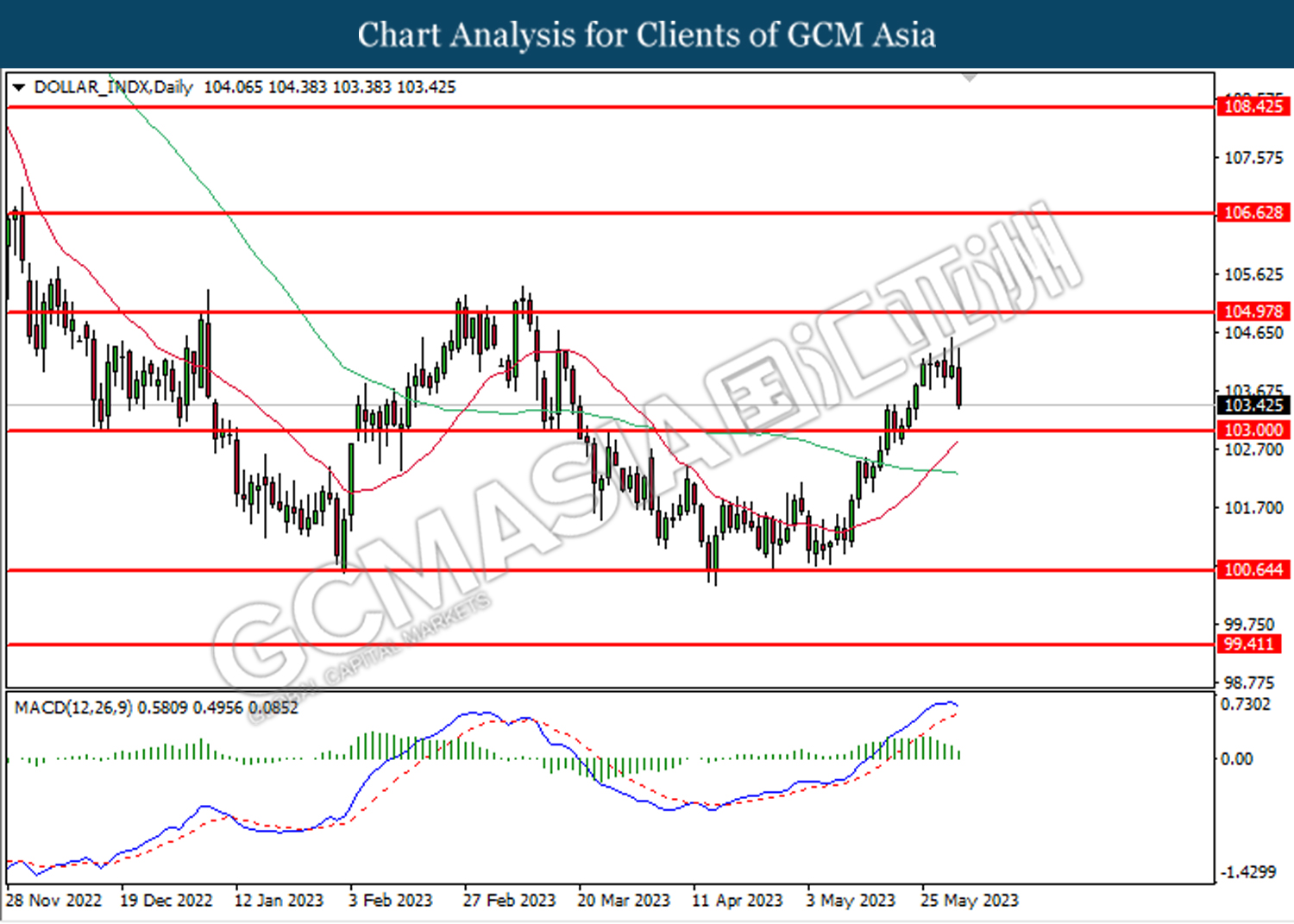

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

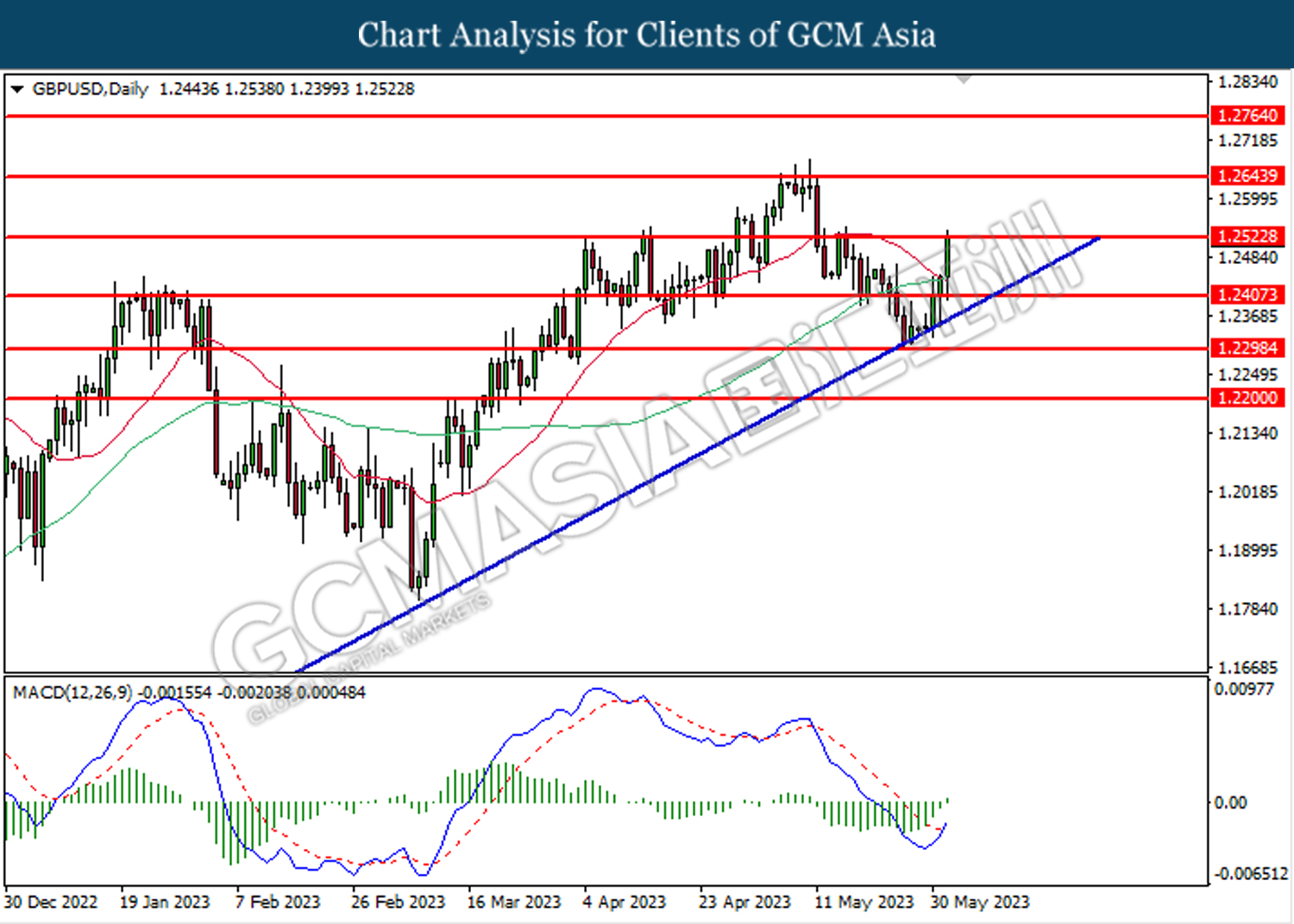

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

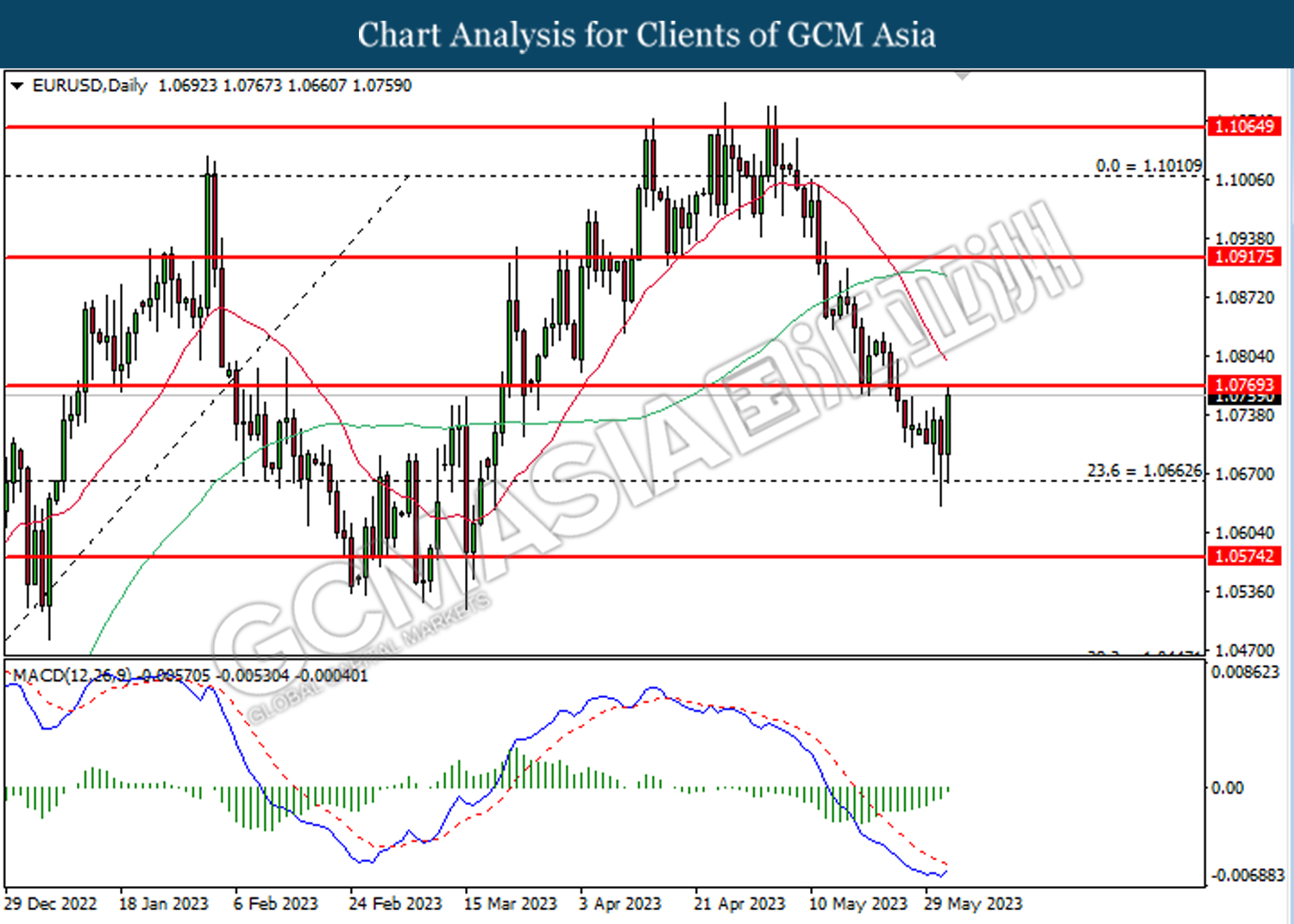

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

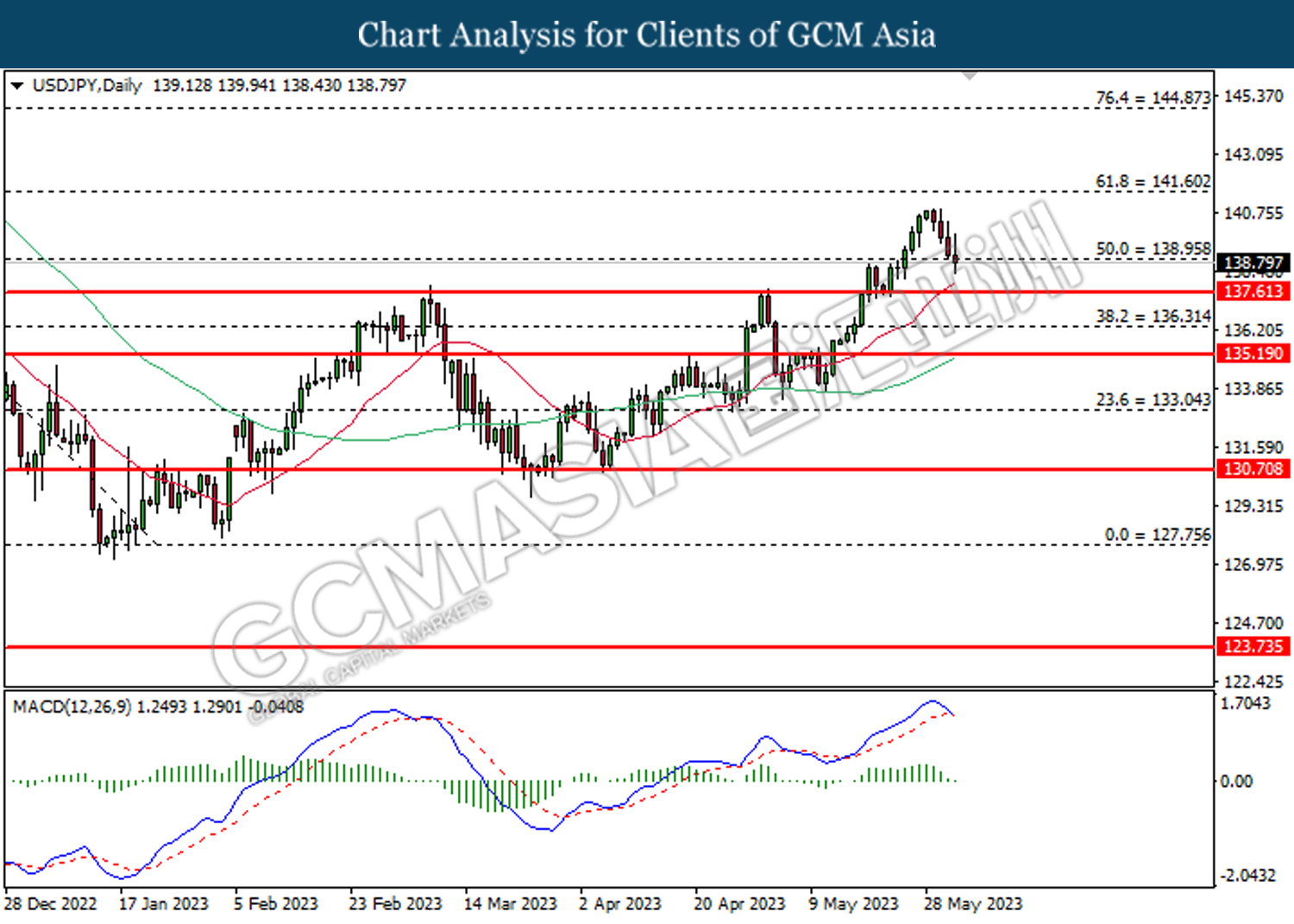

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

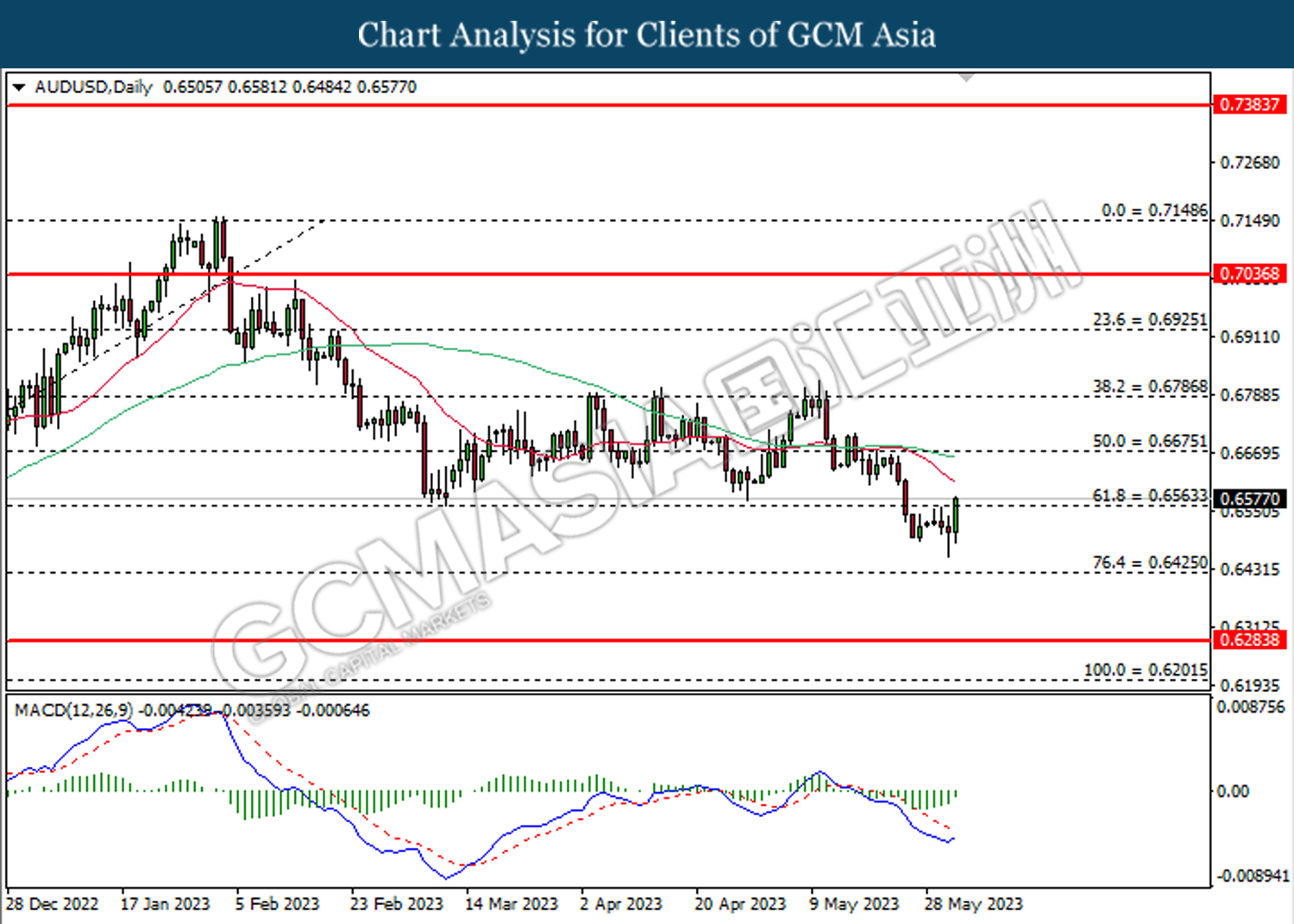

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6565. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

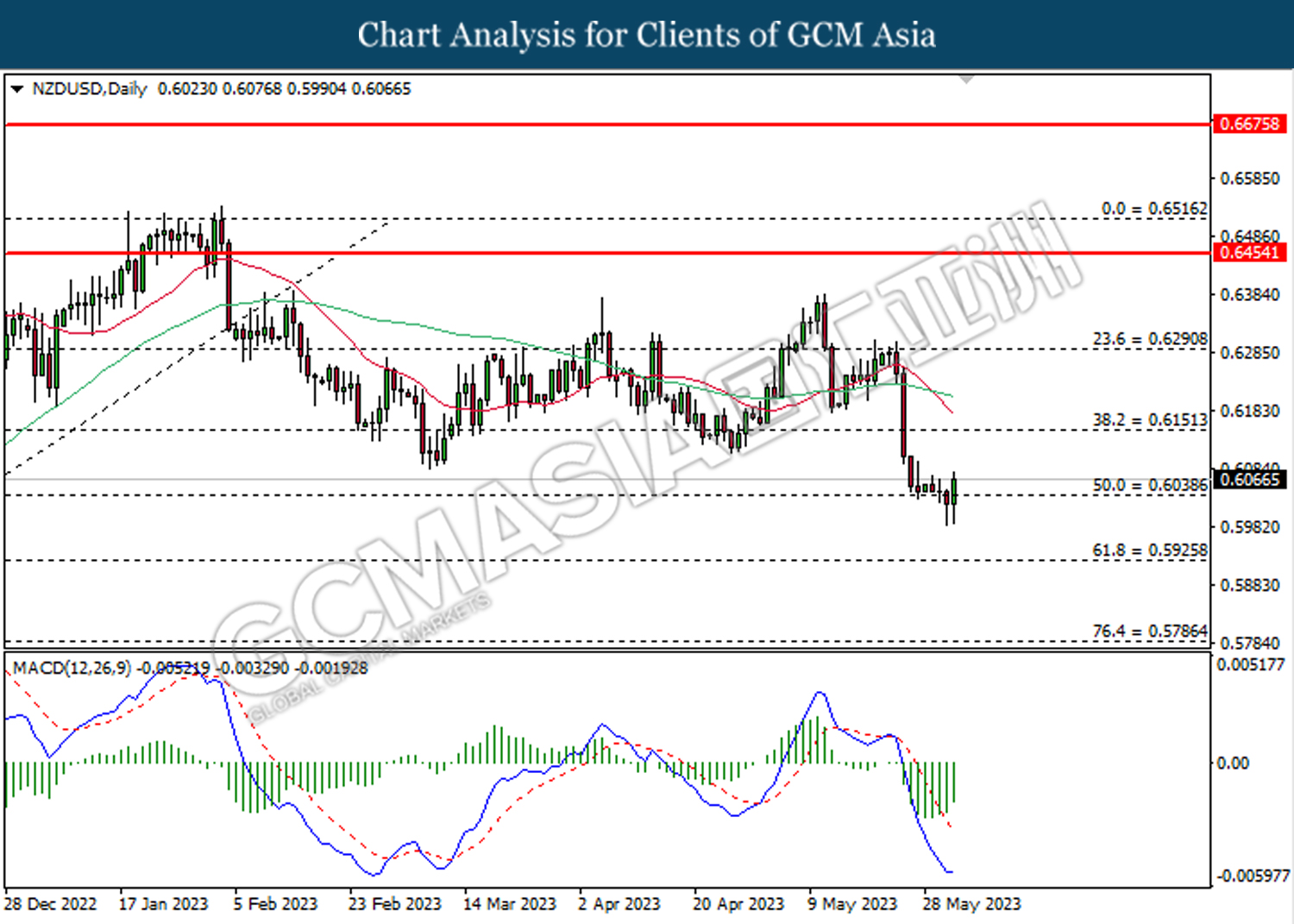

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

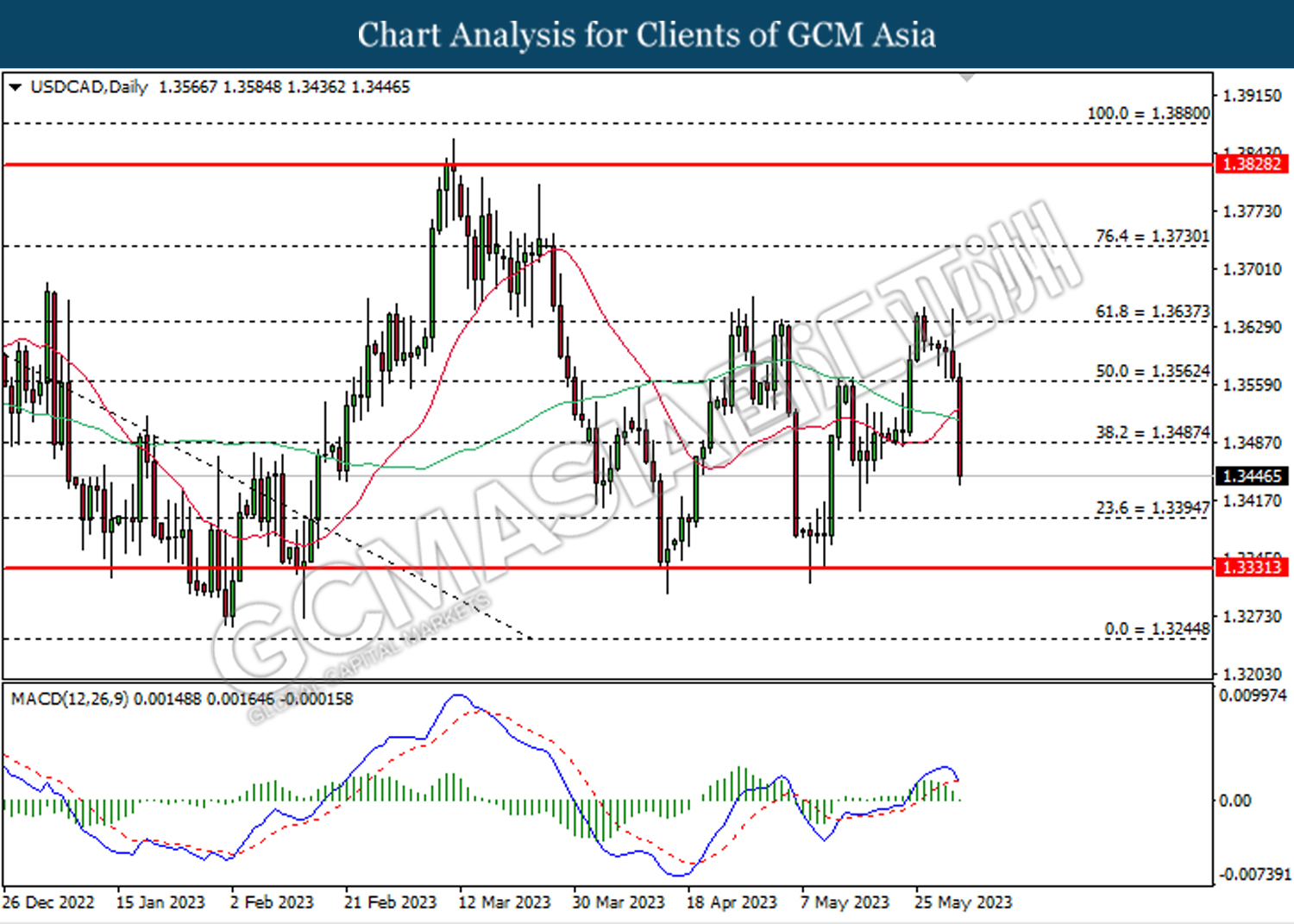

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

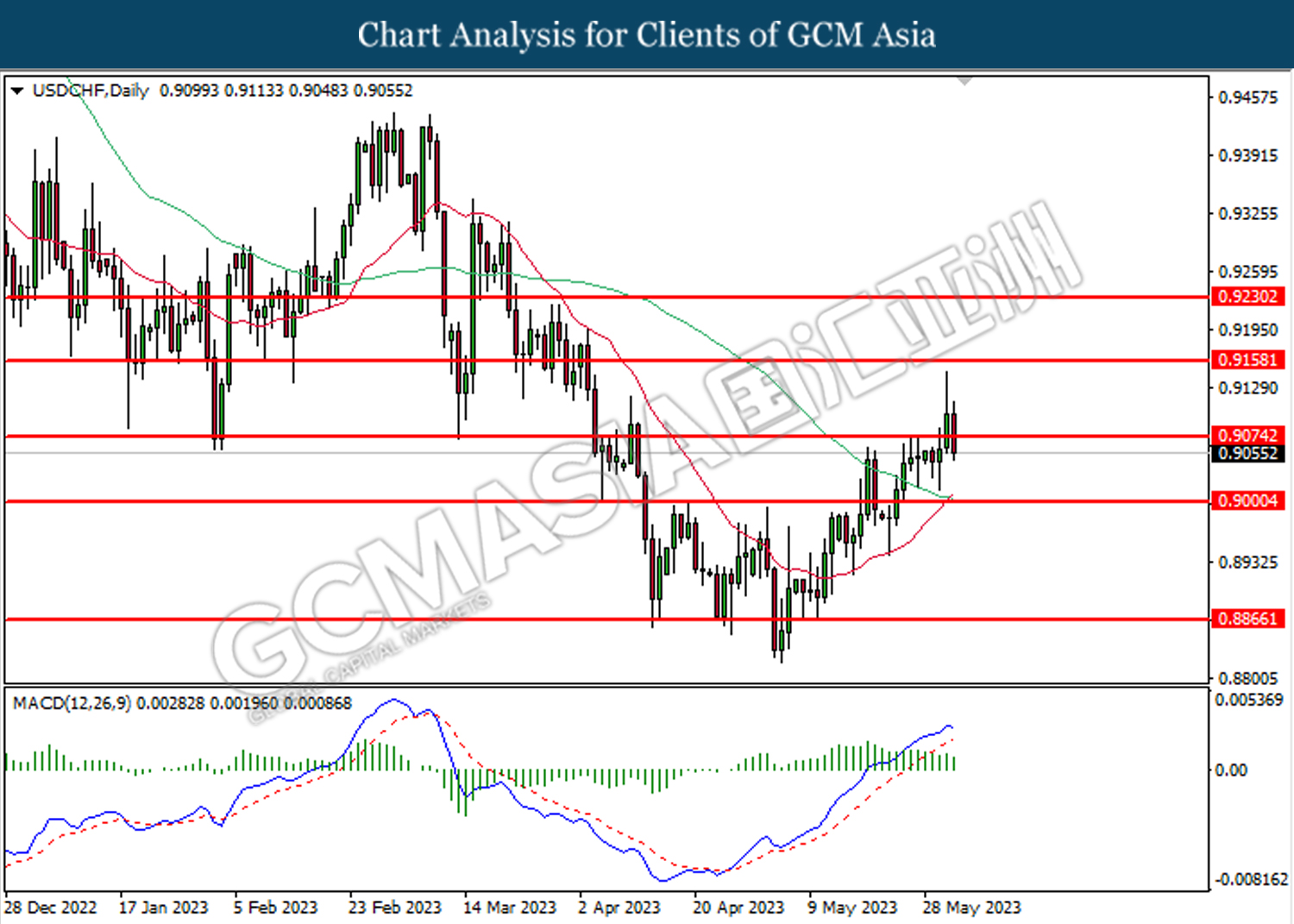

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9075. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9160, 0.9230

Support level: 0.9075, 0.9000

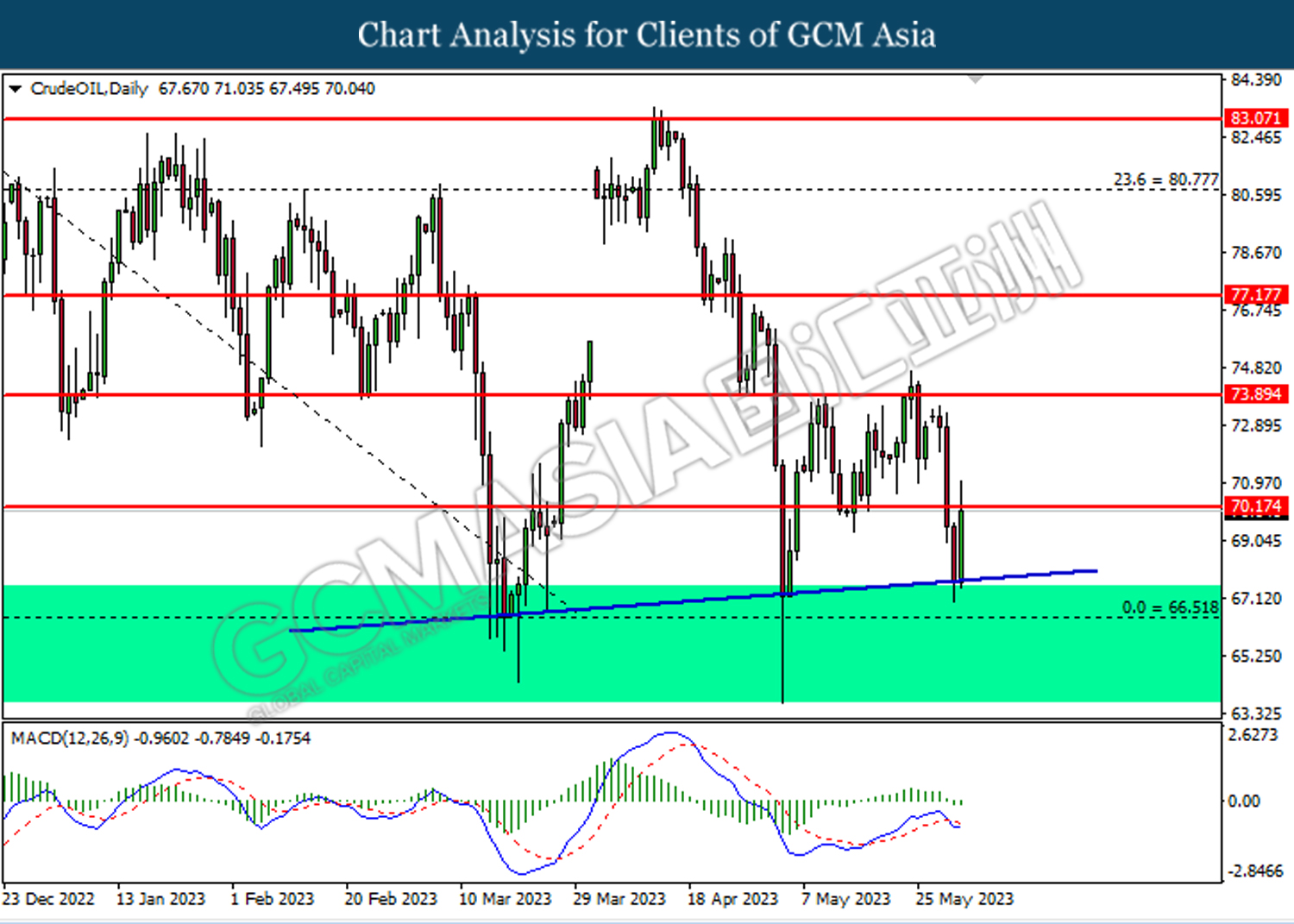

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

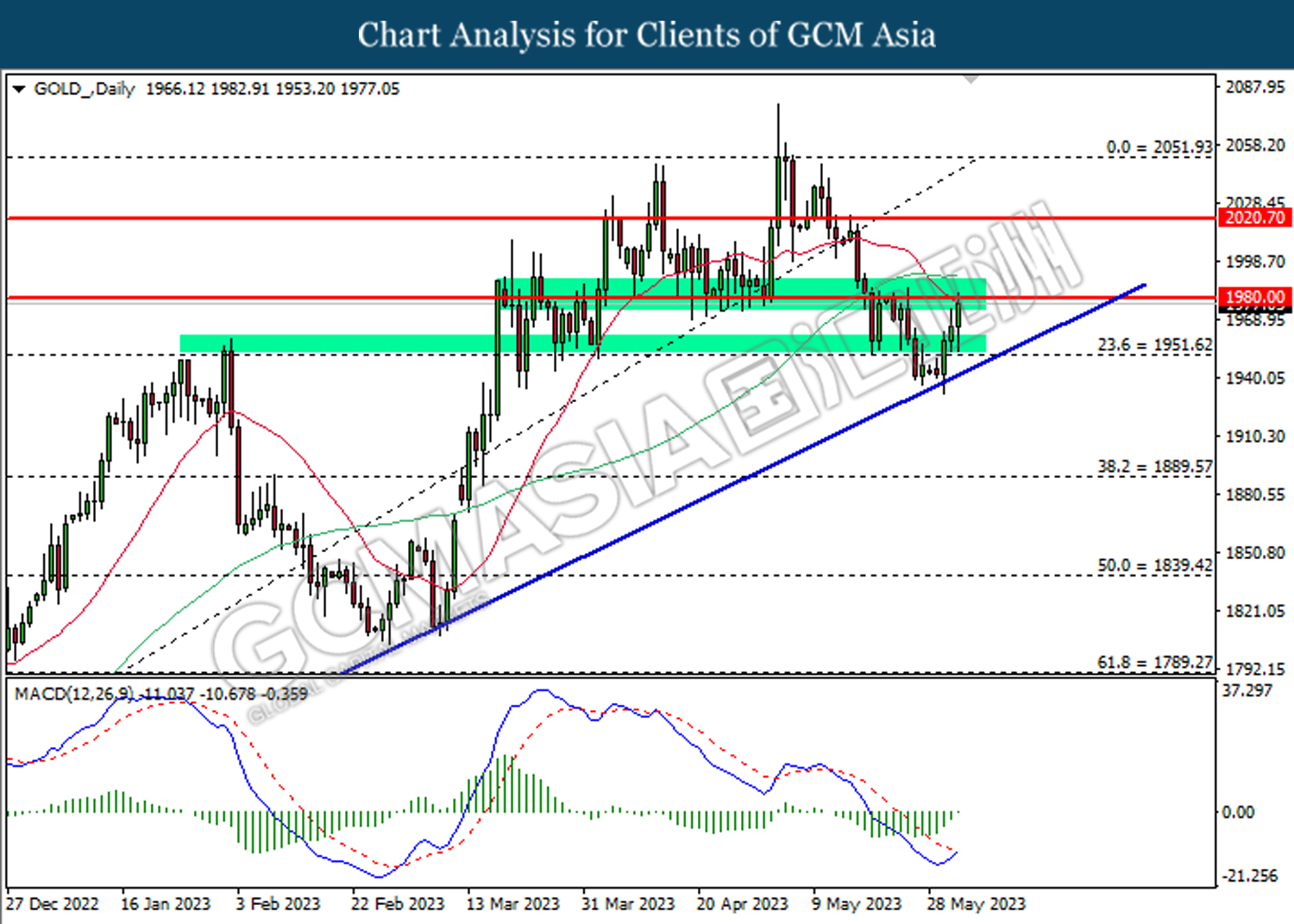

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1980.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55