2 August 2023 Afternoon Session Analysis

AUD weaken after surprise RBA interest rate decisions made

Aussie Dollar (AUD), which was widely traded by global investors, dropped after the announcement of maintaining interest rate decisions. According to the Reserve Bank of Australia (RBA), they decided to maintain the interest rate at 4.10%, but the market forecasted a hike of 25 basis points (bps) to 4.35%. The different results for market forecast and actual outcome caused the AUD to experience a drop as a correction. The recent Australian CPI data proved that inflation is cooling down, while the RBA is trying to prevent a recession in Australia. The condition of the labor market in Australia remains tight, although it eased a fair bit recently. On the other hand, the US has reported a series of outstanding economic data, such as US GDP and initial jobless claims. Although the recent PMI data did not exceed the market forecast but still performed better than the previous month. In the current situation, the US economic conditions are much better than Australia, dragging the currencies pair AUD/USD downward. As of writing, AUD/USD dropped -0.06% to 0.6605.

In the commodities market, crude oil prices spiked 1.06% to 82.25 per barrel amid by the API weekly crude oil stock showed a huge draw, therefore investors forecast the coming EIA inventories report will be negative too. Besides, gold prices rose 0.17% to 1947.40 per troy amid the US government credit rating has downgraded made investors lost confident on US dollar then dollar index dropped.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jul) | 497K | 188K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.600M | -0.071M | – |

Technical Analysis

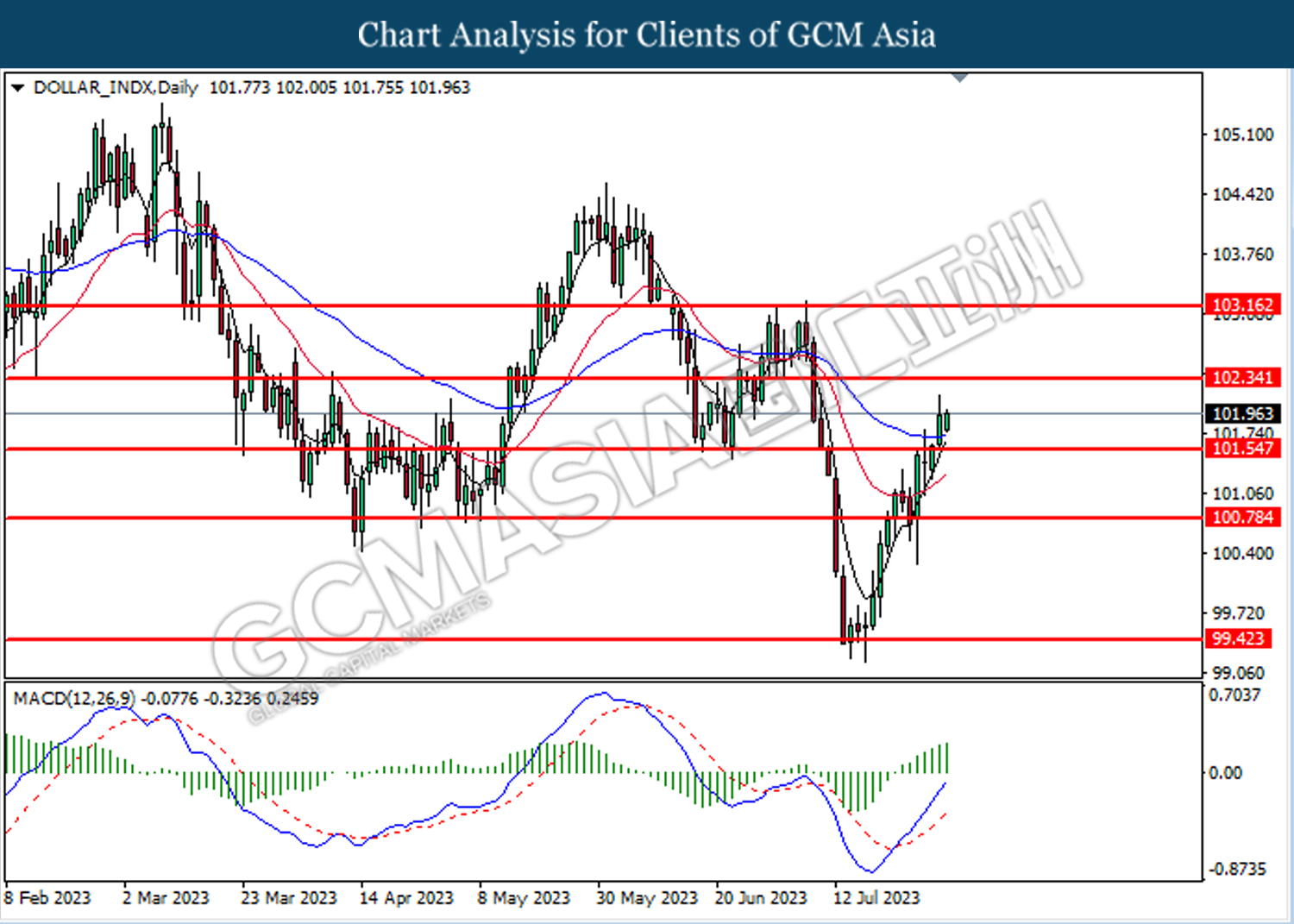

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.55. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level at 102.35.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

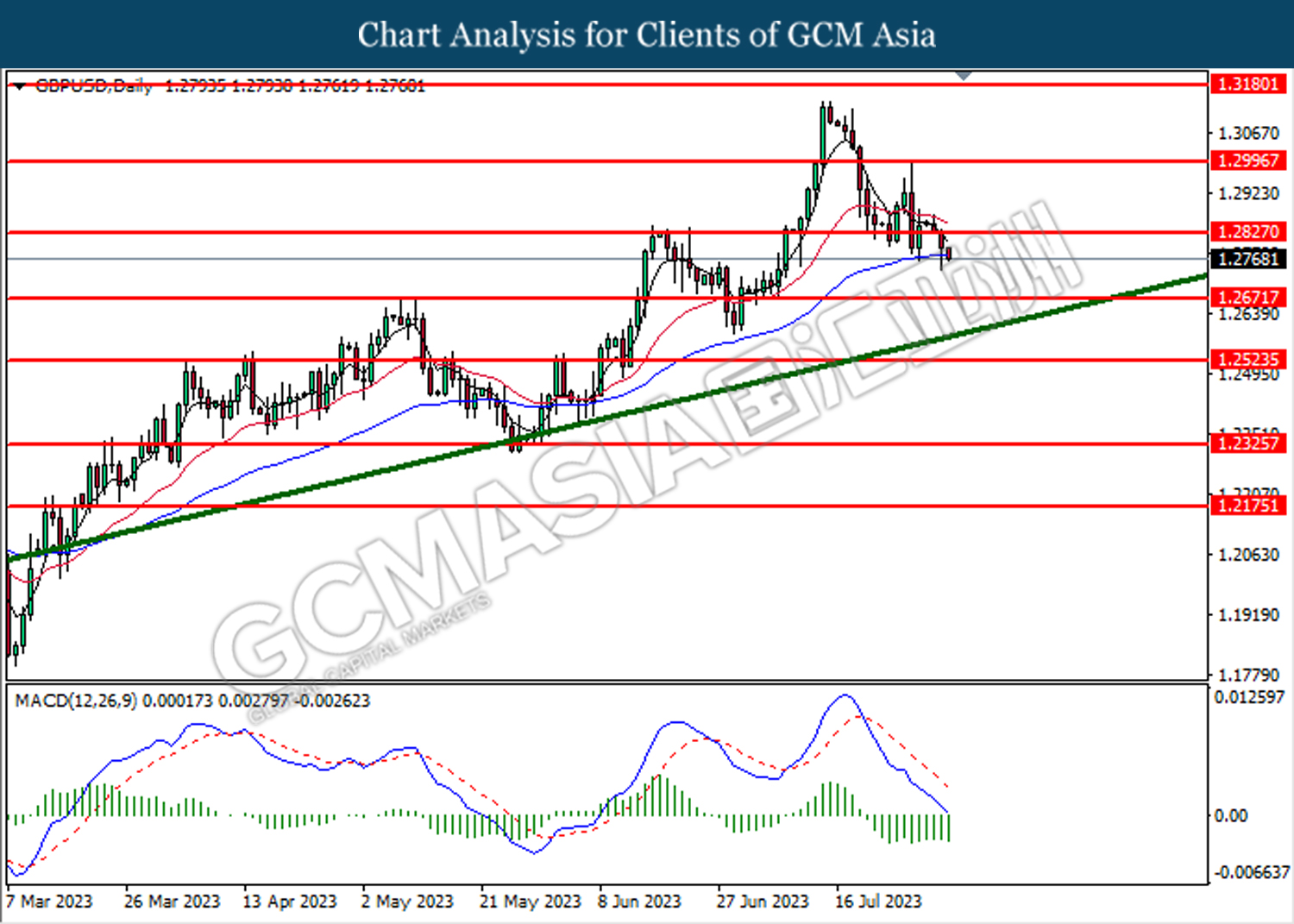

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2830. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.2670.

Resistance level: 1.2830, 1.3000

Support level: 1.2670, 1.2525

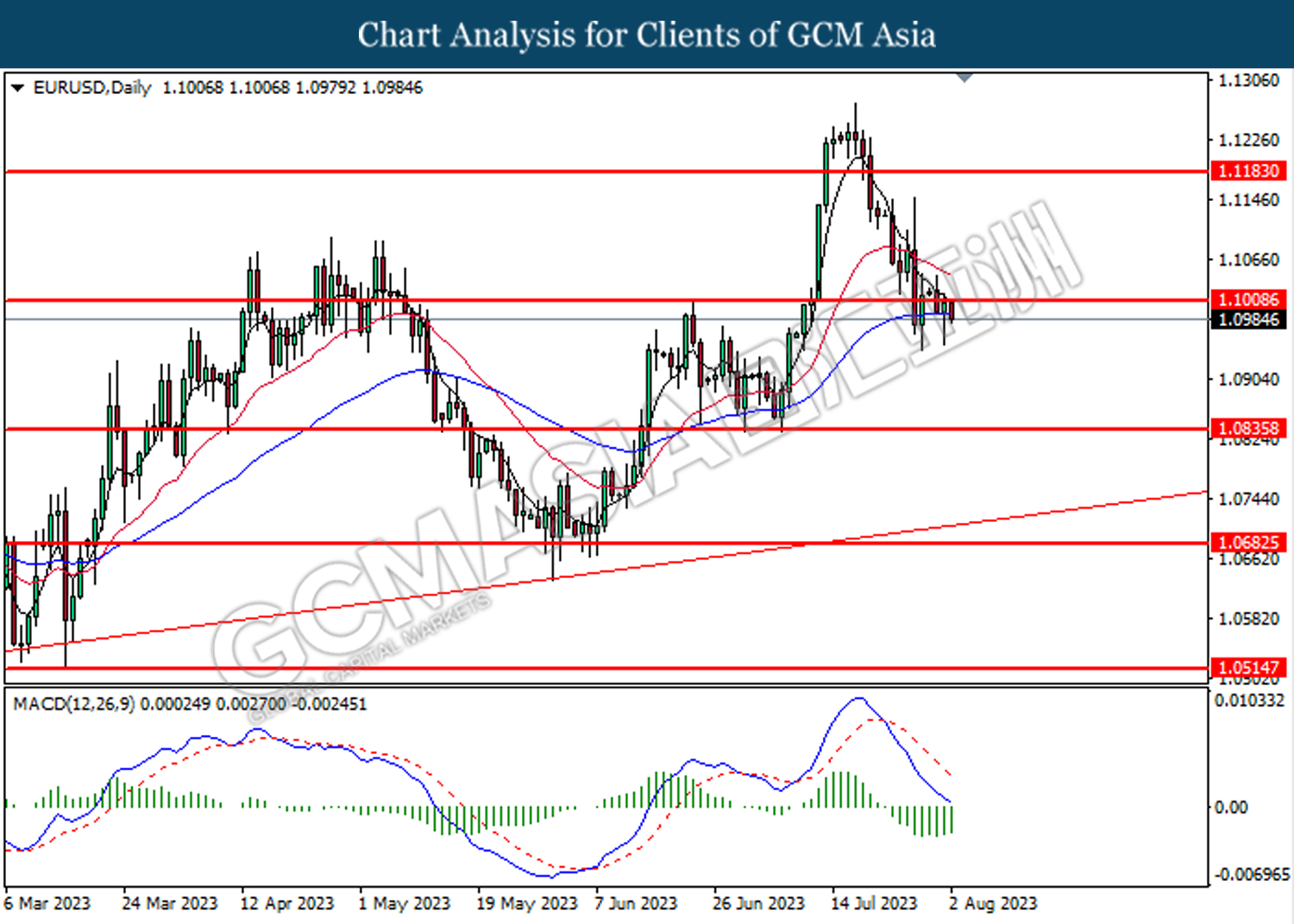

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

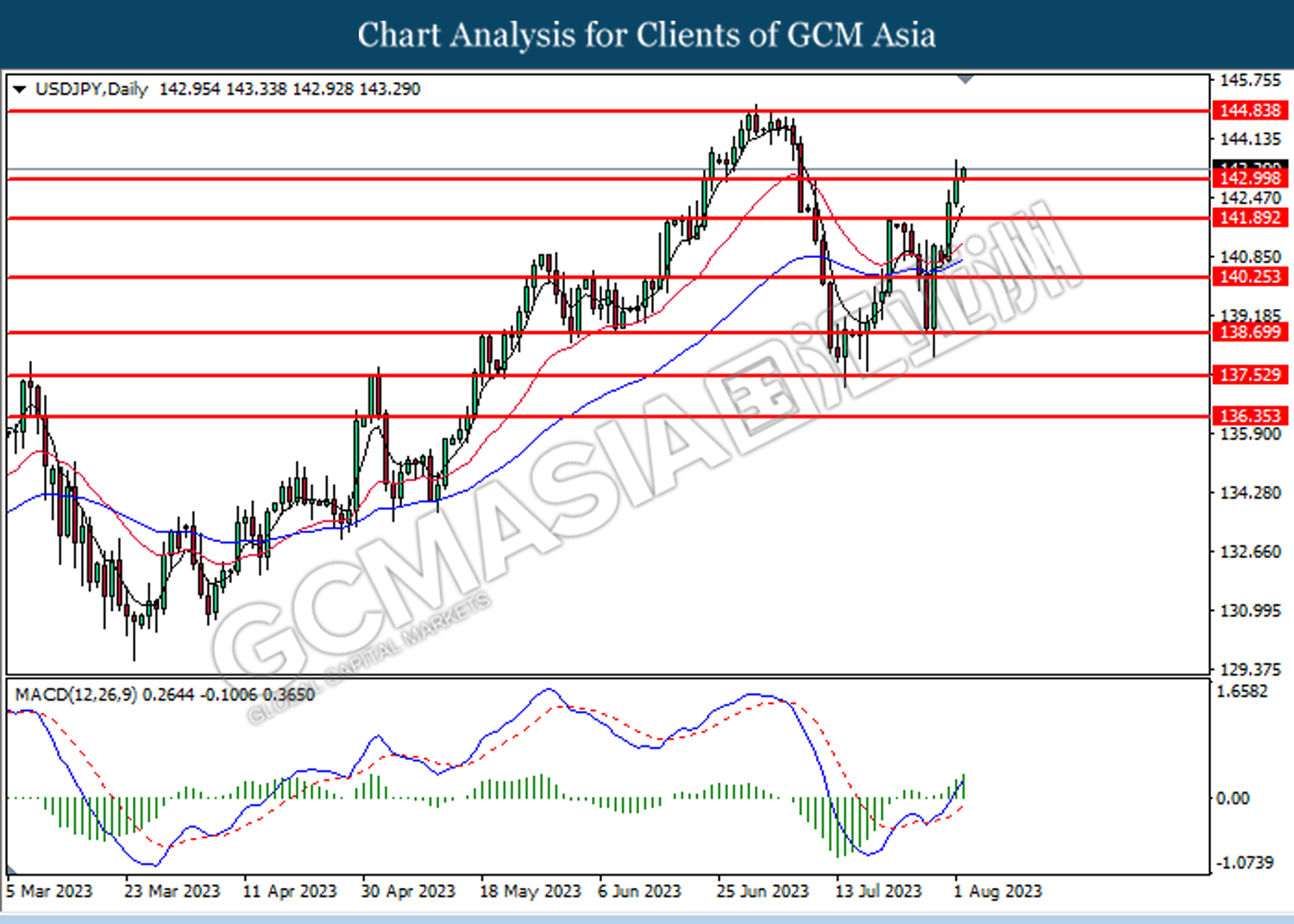

USDJPY, Daily: USDJPY was traded higher while testing the resistance level at 143.00. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 143.00, 144.85

Support level: 141.90, 140.25

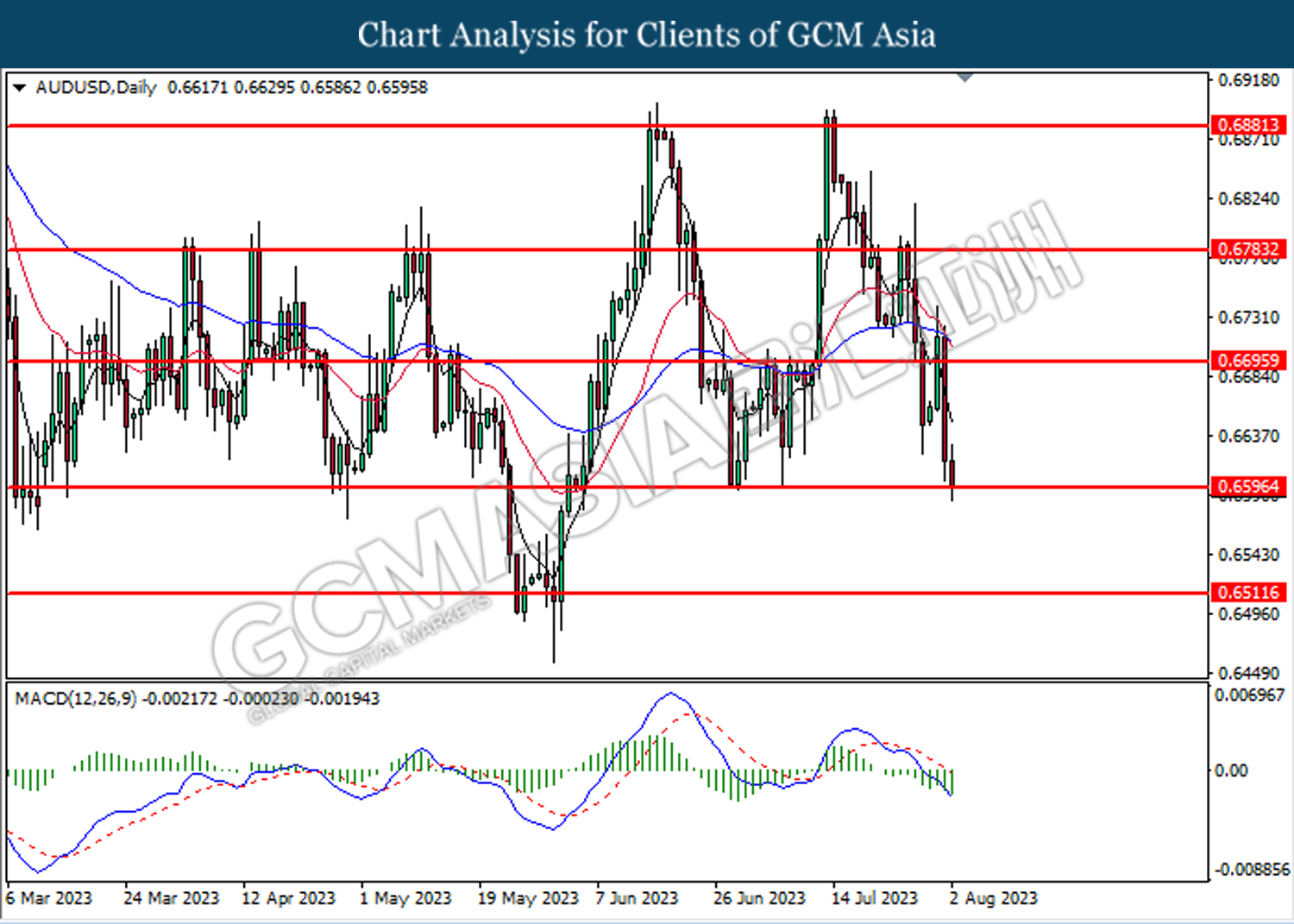

AUDUSD, Daily: AUDUSD was traded lower while testing the support level at 0.6695. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after it breakout the support level.

Resistance level: 0.6785, 0.6880

Support level: 0.6695, 0.6595

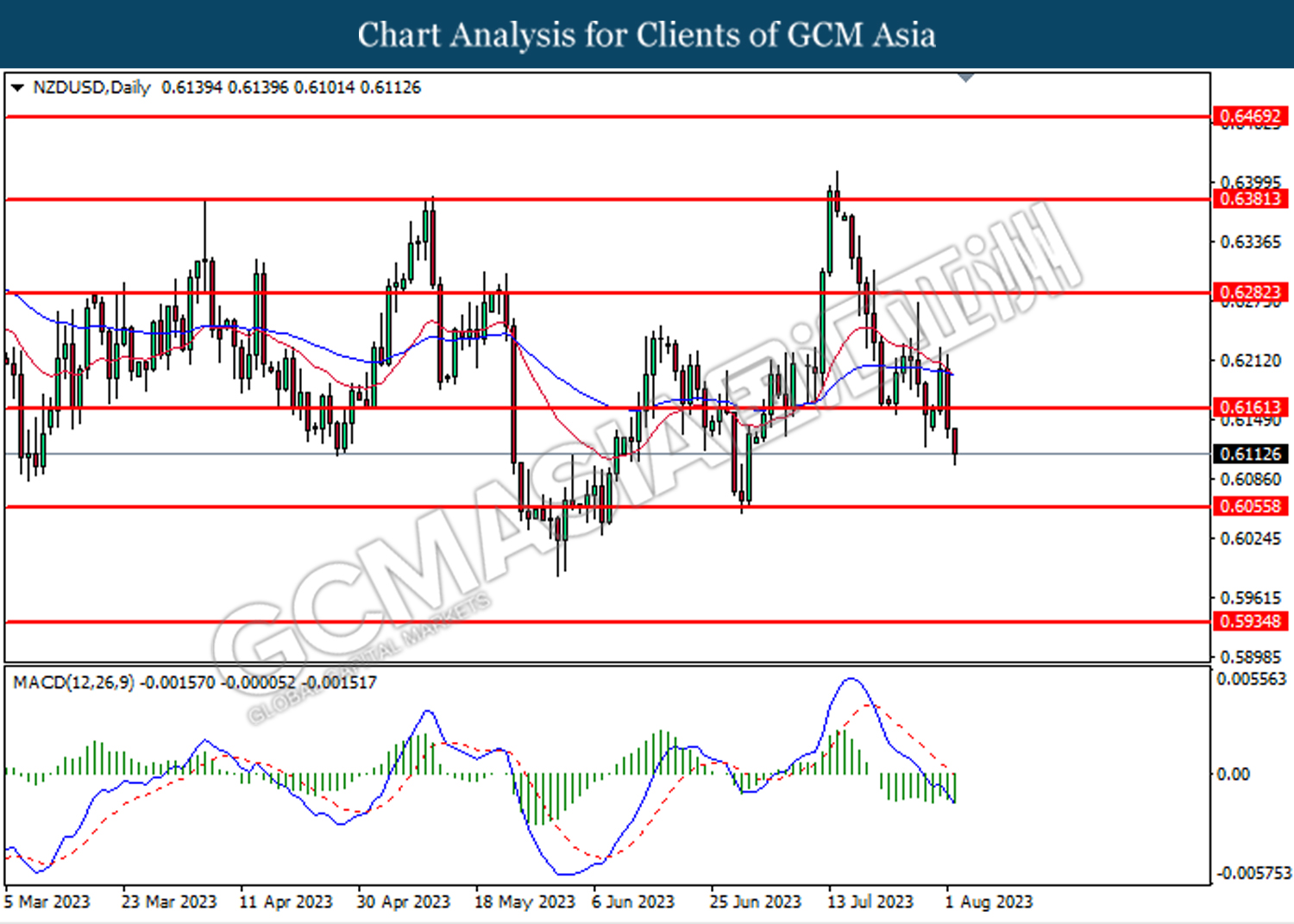

NZDUSD, Daily: NZDUSD was traded lower following the prior after breakout below the previous support level at 0.6160. MACD which illustrated decreasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6055.

Resistance level: 0.6160, 0.6280

Support level: 0.6055, 0.5935

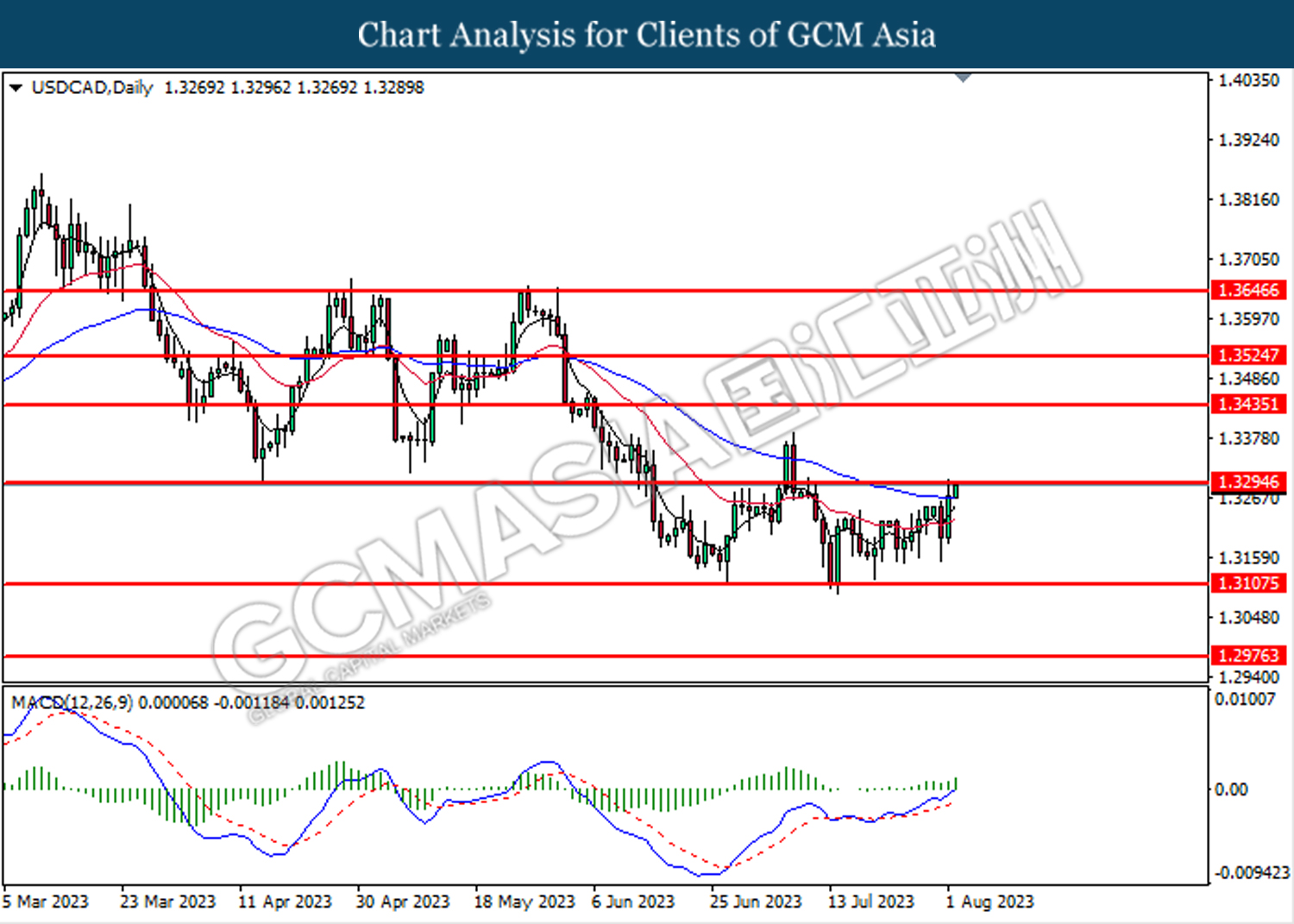

USDCAD, Daily: USDCAD was traded higher while testing the resistance level at 1.3295. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after breakout the resistance level.

Resistance level: 1.3295, 1.3435

Support level: 1.3110, 1.2975

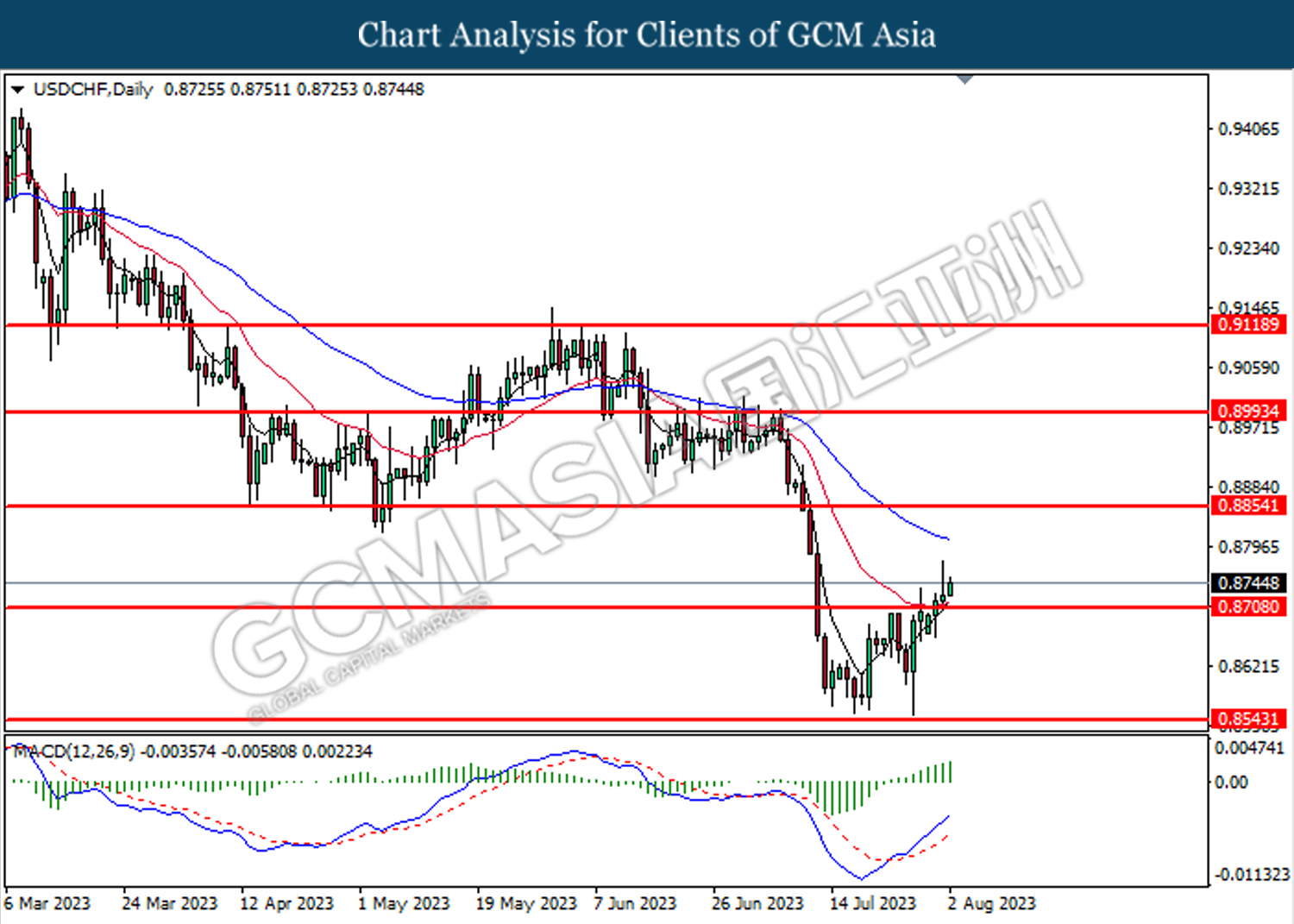

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.8855

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

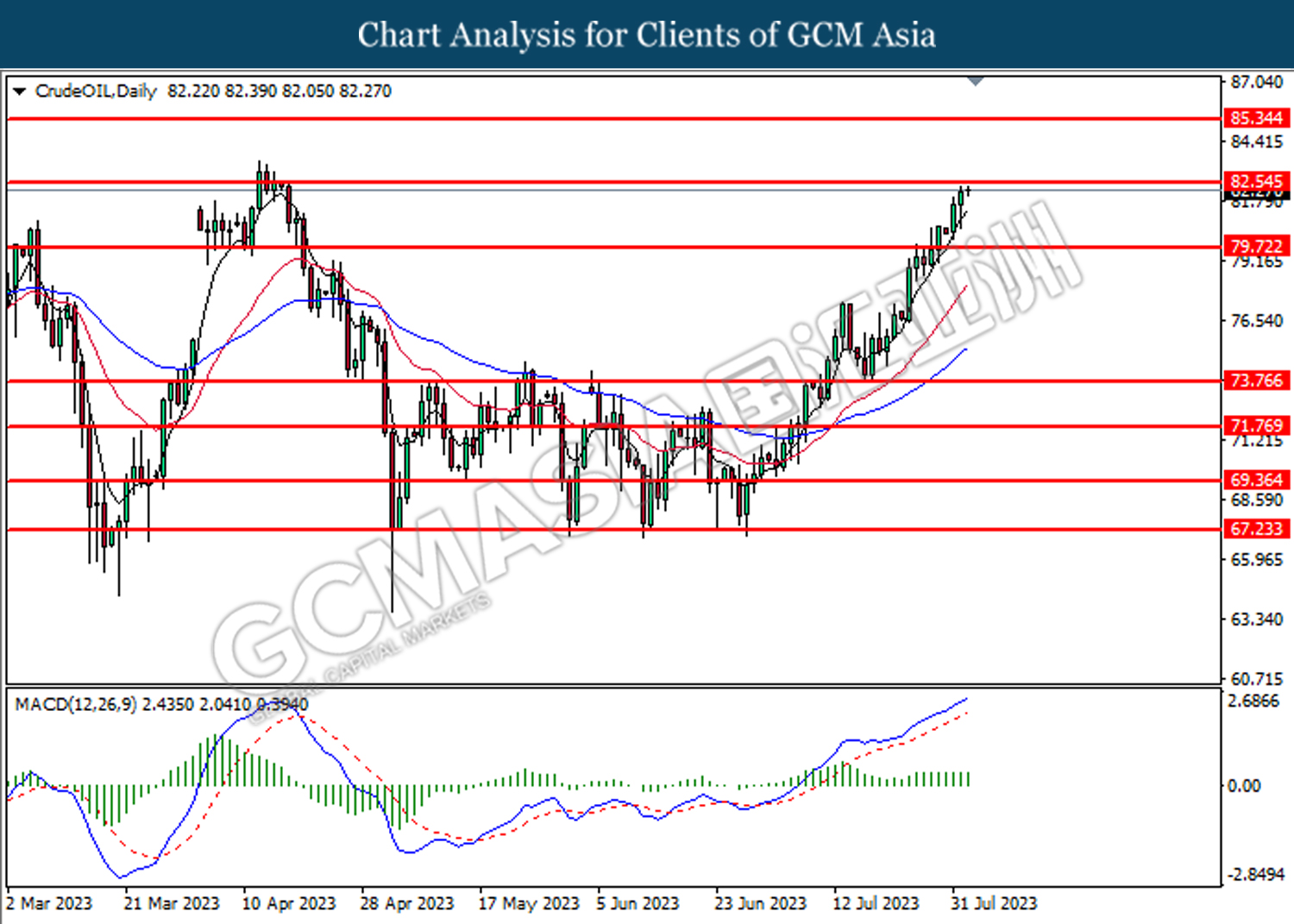

CrudeOIL, Daily: Crude oil price was traded higher while testing the resistance level at 85.35. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains after breakout the resistance level.

Resistance level: 82.55, 85.35

Support level: 79.70, 77.25

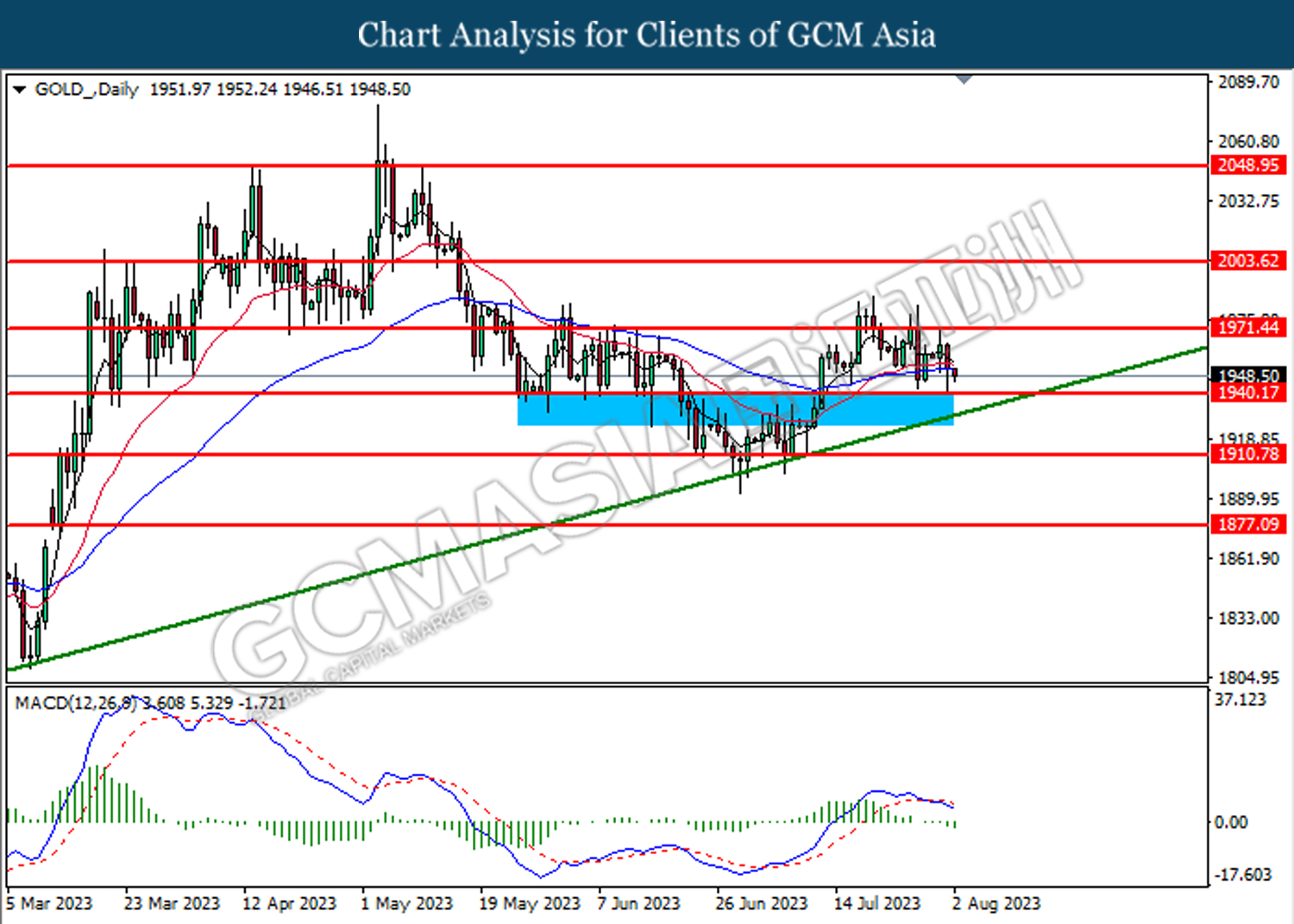

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1971.45. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1940.20.

Resistance level: 1971.45, 2003.60

Support level: 1940.20, 1910.80