2 August 2023 Morning Session Analysis

US Dollar hangs tough despite disappointing economic data.

The dollar index, which was traded against a basket of six major currencies, managed to hold its foot of gains, while lingering near the recent high level despite the nation has released downbeat economic data yesterday’s night. On 1st August, the Institute for Supply Management released its report on the ISM Manufacturing PMI for July. The data showed a slight improvement as the PMI increased from 46 in June to 46.4 in July. However, this figure was slightly lower than the analyst consensus of 46.8. Despite the uptick in the PMI, the U.S. manufacturing sector continued to contract in July for the 9th consecutive month. The overall demand remained weak, although there was a marginal improvement compared to June. Production was hampered by a lack of work, and suppliers still had available capacity. In regards to employment, the U.S. Bureau of Labor Statistics (BLS) reported that on the last business day of June, there were 9.58 million job openings. This number was a decline from the 9.82 million openings recorded in May and fell slightly below the market’s expectation of 9.62 million. Even though job openings reached their lowest level in over two years in June, they still suggested tight labor market conditions. As a result, there may be implications for the Federal Reserve’s interest rate decisions, with the possibility of keeping rates elevated for a prolonged period. Hence, these downbeat data failed to ‘stop the bull’ in dollar market, leaving the currency at high level. As of writing, the dollar index rose 0.10% to 101.96.

In the commodities market, crude oil prices were up by 0.12% to $82.35 per barrel following a huge draw in US oil inventories throughout the entire past one week. According to the API, the US oil inventories level declined by -15.400M, far lower than the analyst consensus at -0.900M. Besides, gold prices ticked up by 0.30% to $1950.00 per troy ounce as market risk aversion heightened after Fitch downgraded the US Long term ratings to AA+ from AAA.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jul) | 497K | 188K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.600M | -0.071M | – |

Technical Analysis

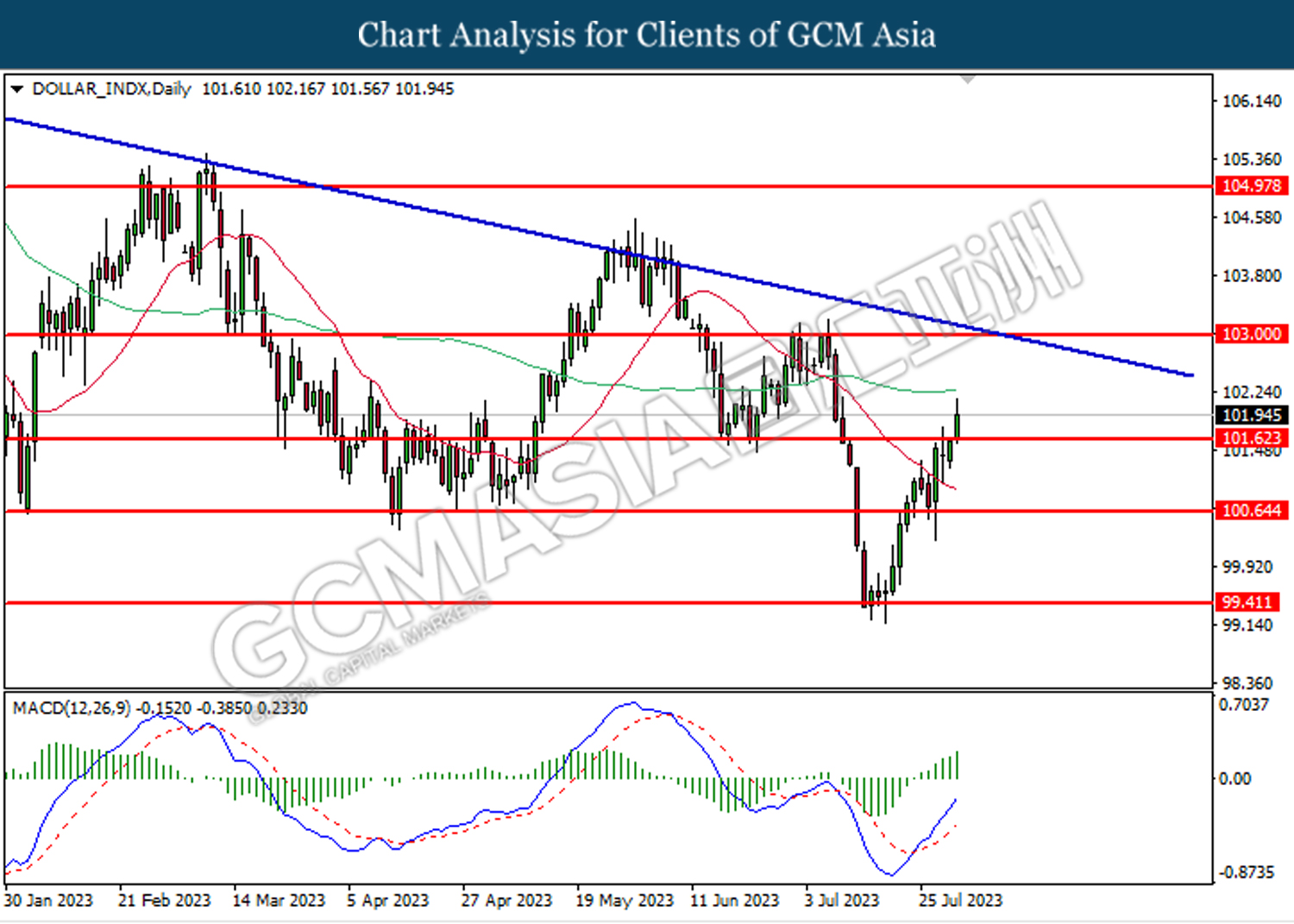

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

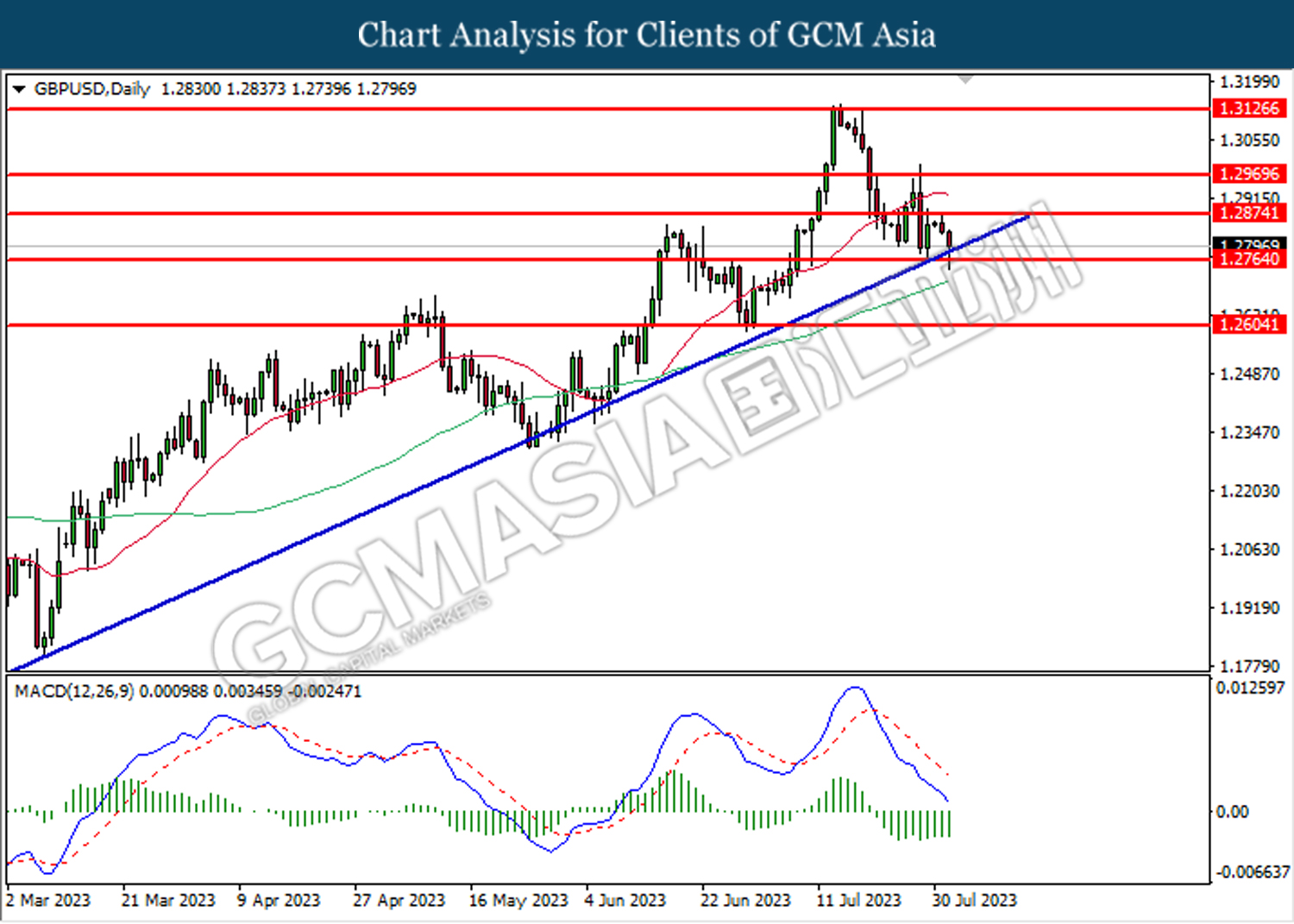

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

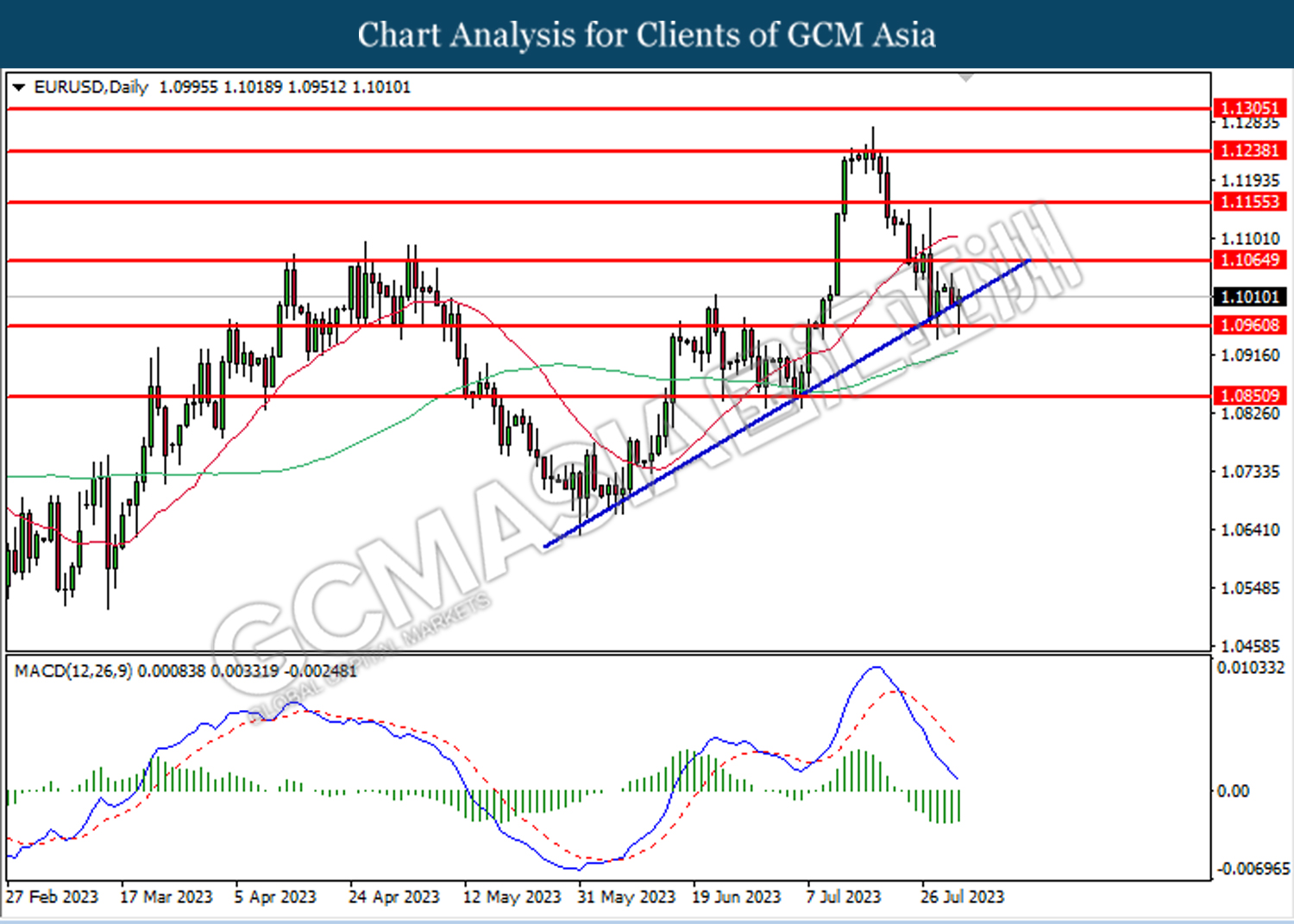

EURUSD, Daily: was traded lower while currently retesting the upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

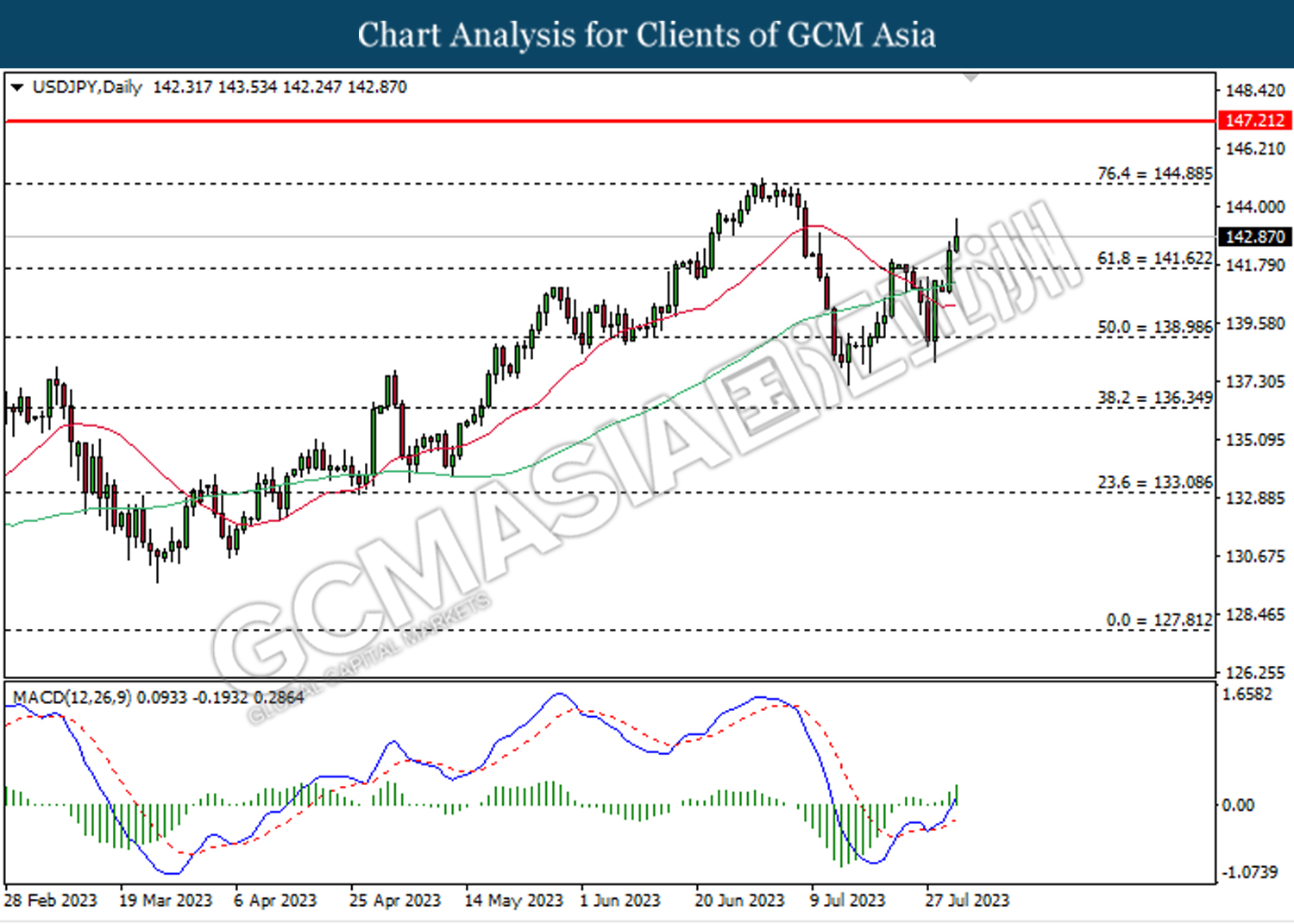

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

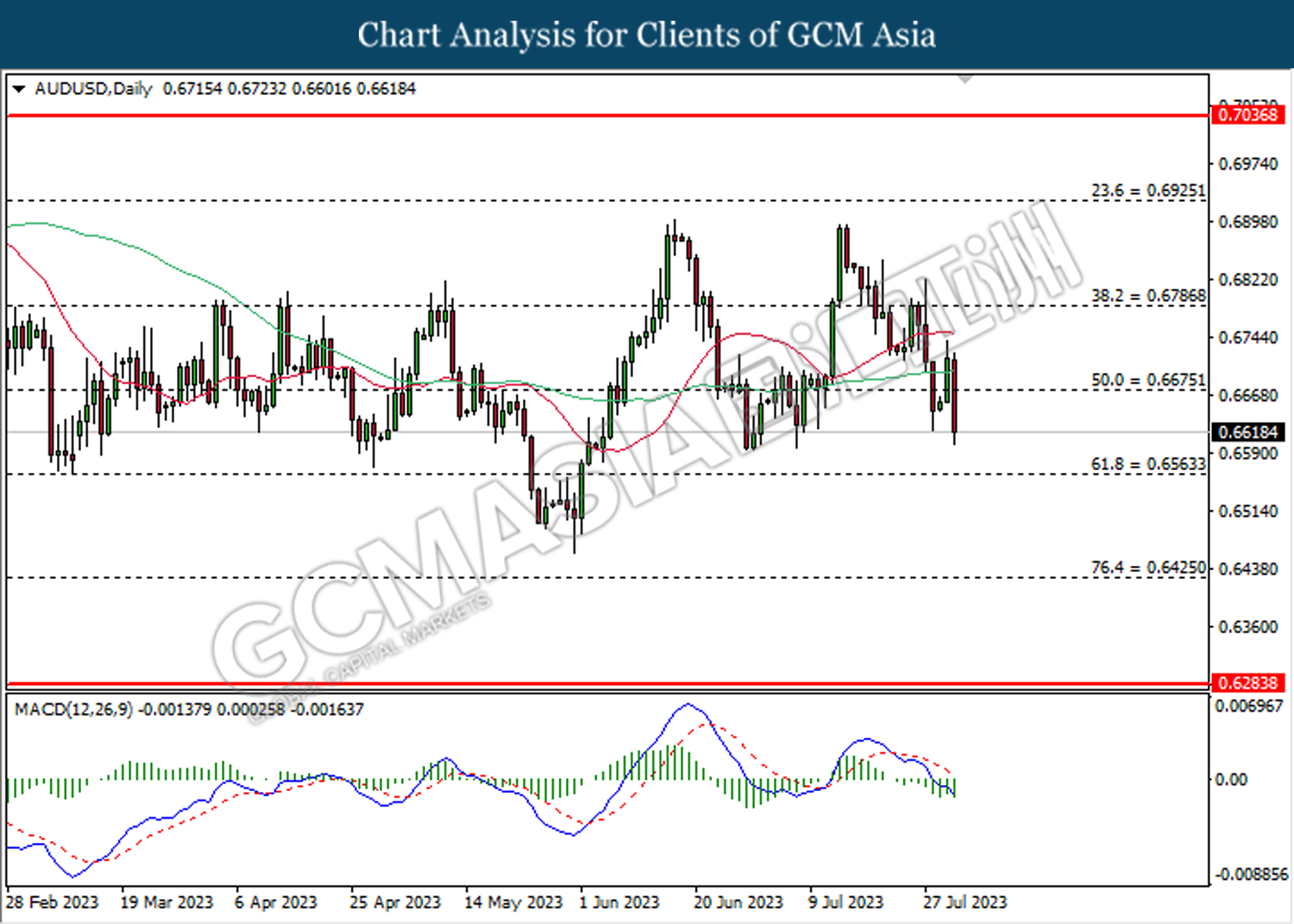

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

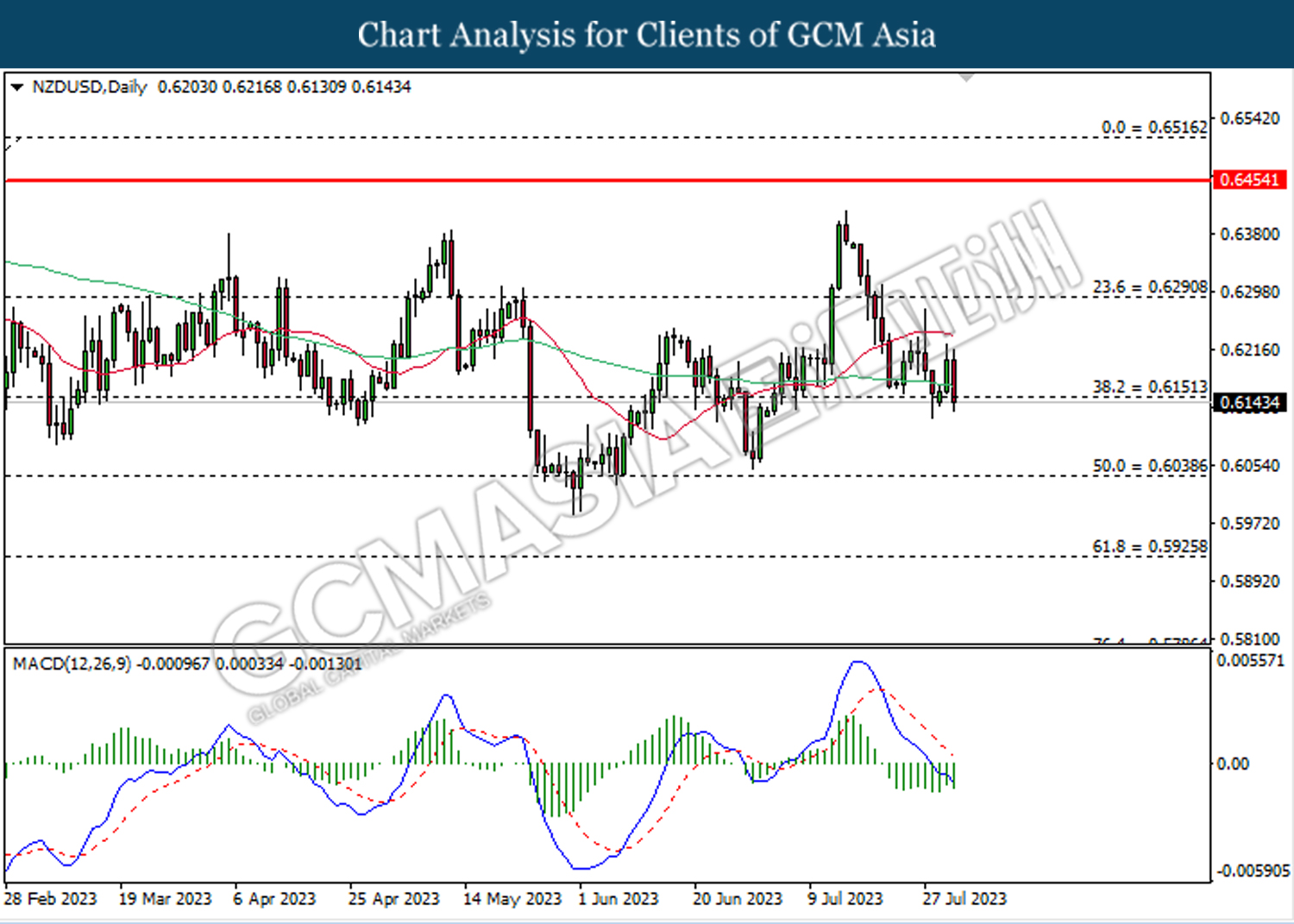

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

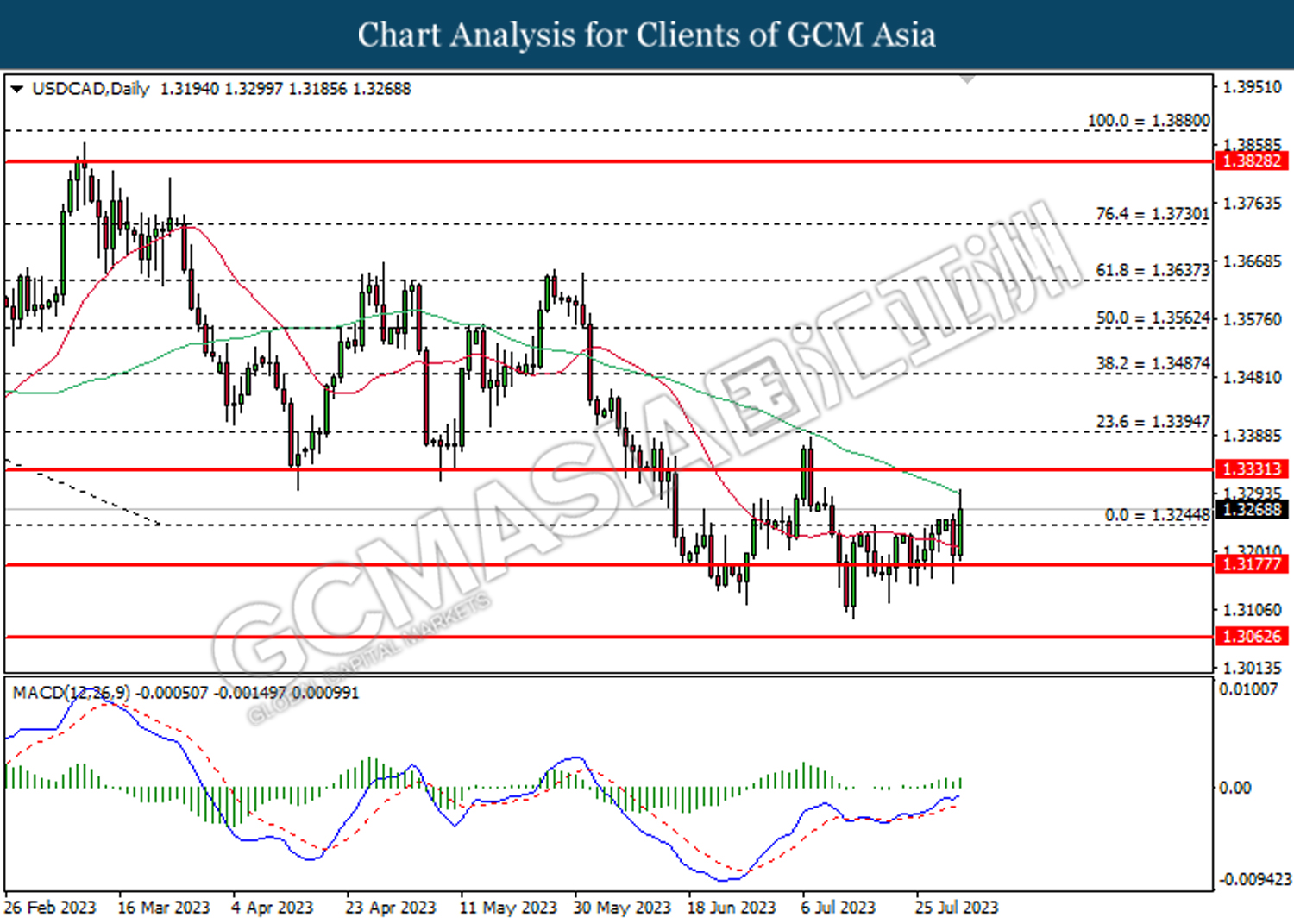

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

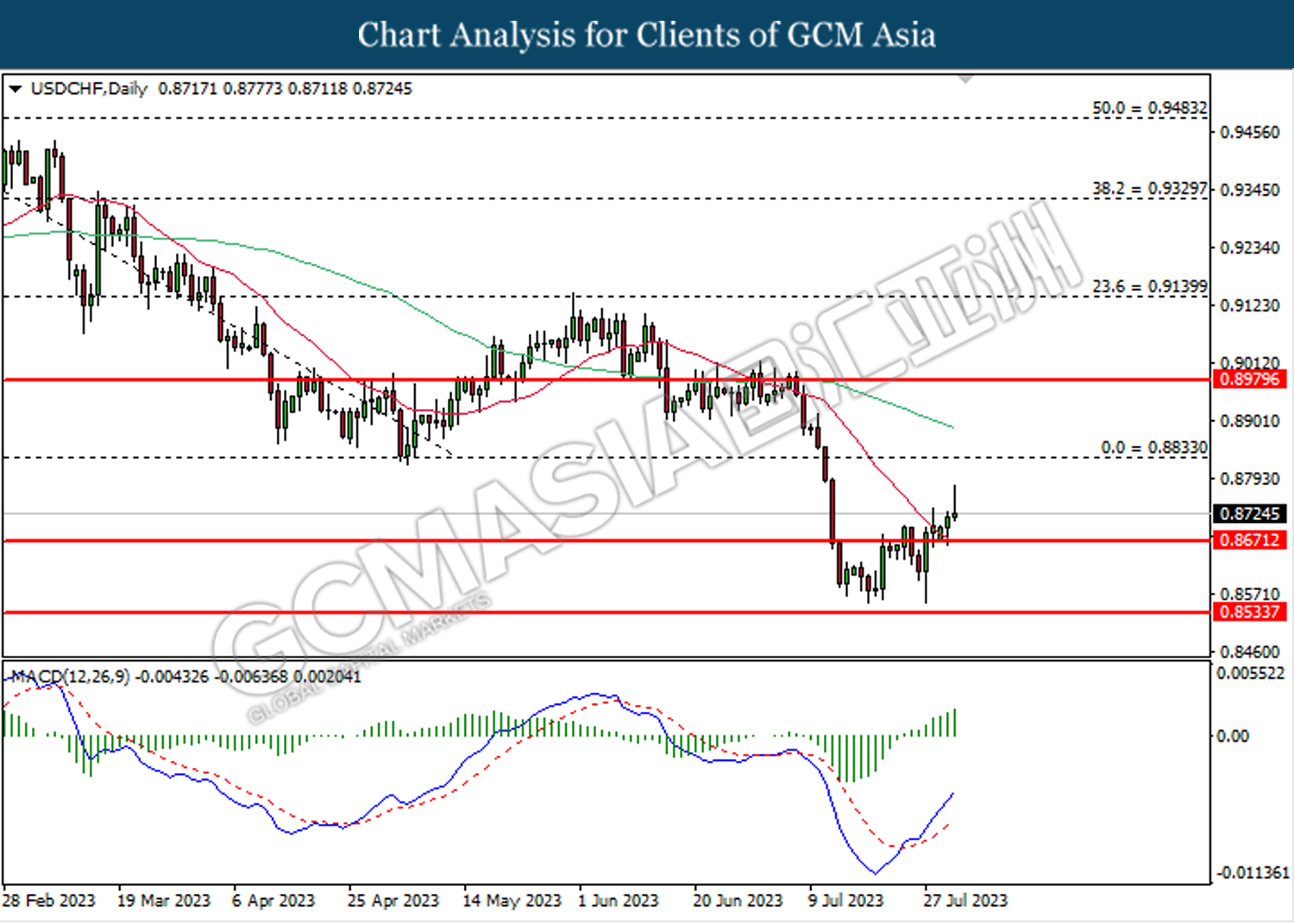

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

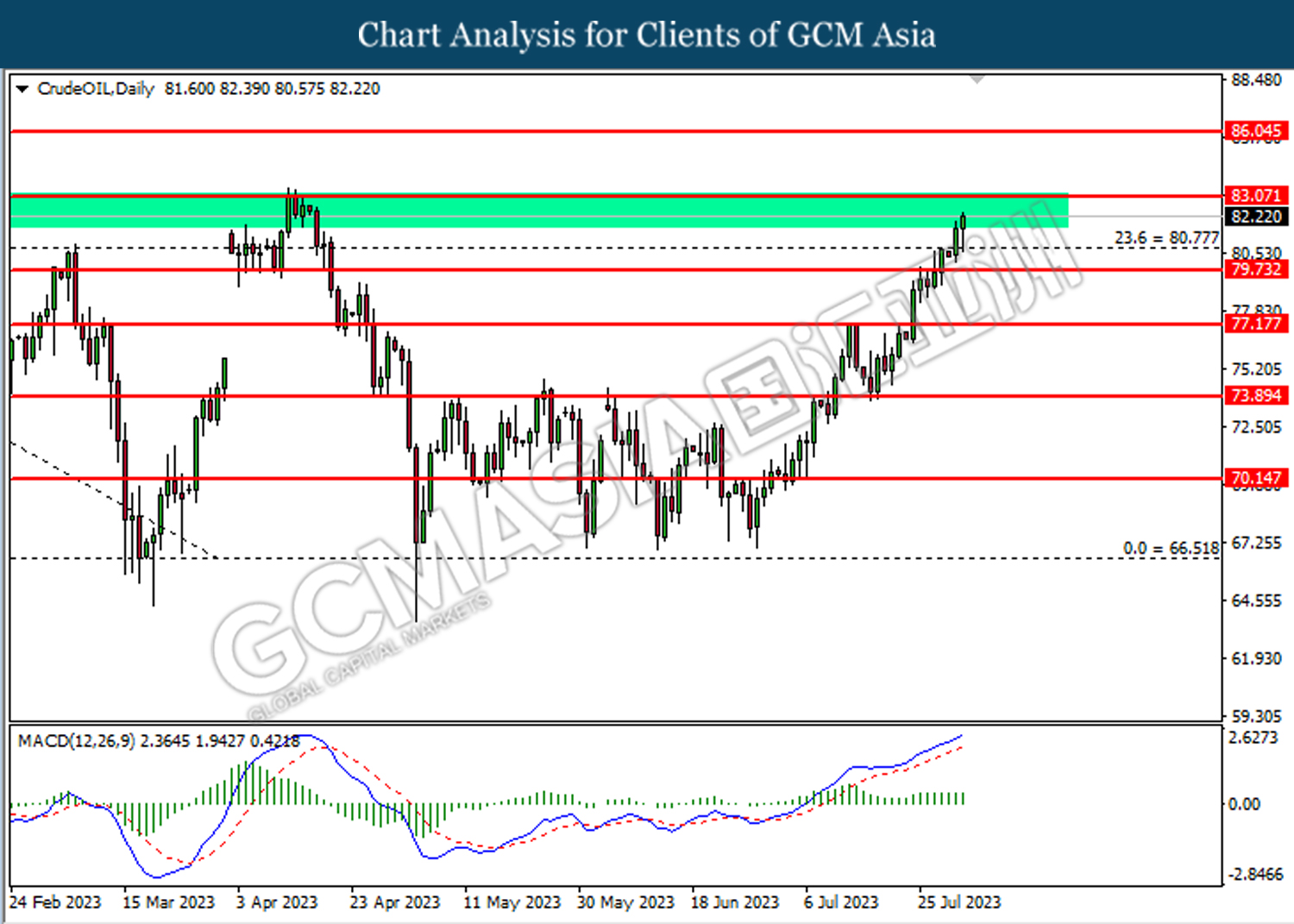

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 83.05.

Resistance level: 83.05, 86.05

Support level: 80.75, 79.75

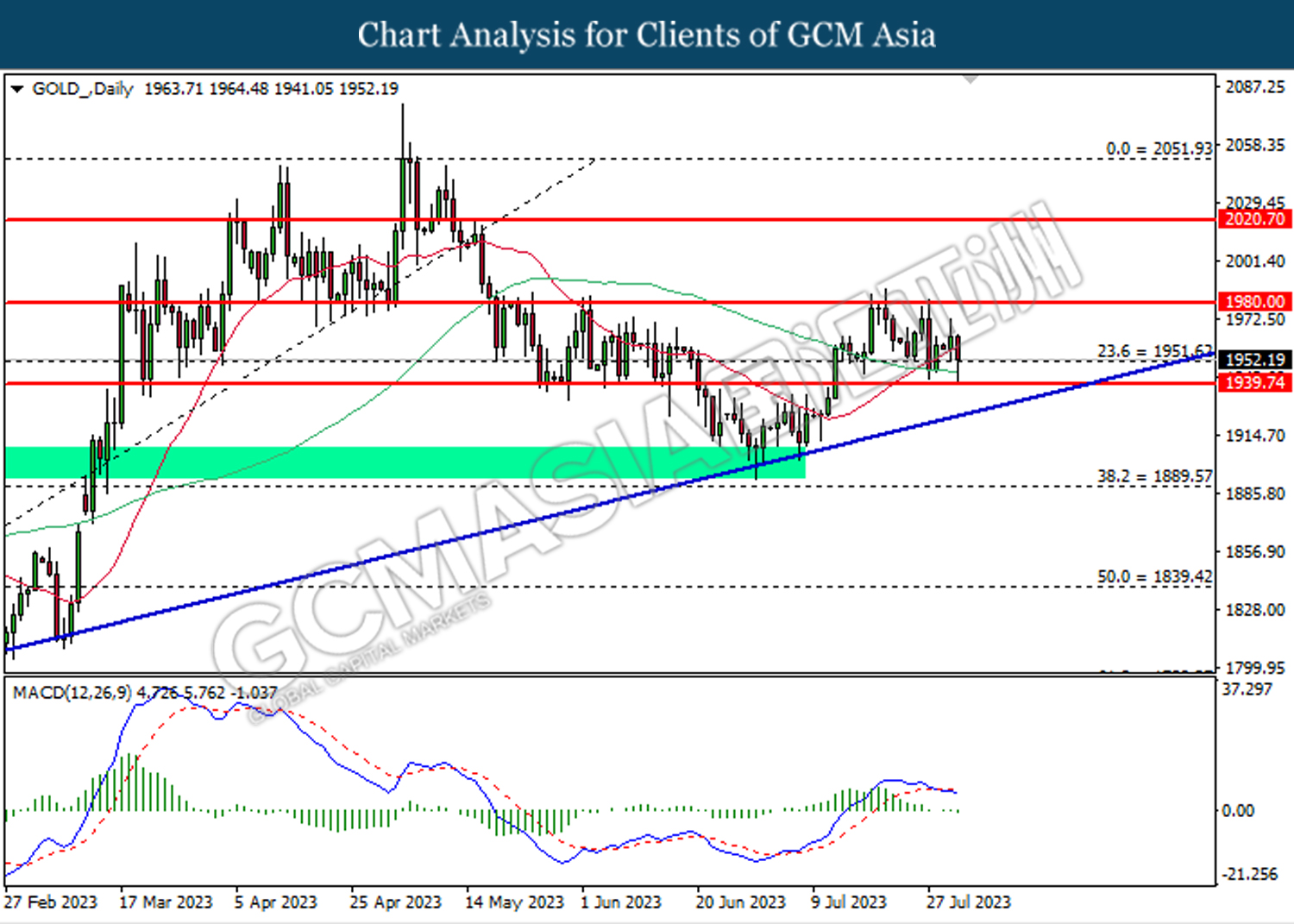

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75