02 September 2020 Afternoon Session Analysis

Pound weaken amid talk deadlock remains.

Pound sterling which broadly traded by the market participants in Fx market retreated from its 9 month highs level amid growing likelihood of no deal Brexit. Since after UK voted to leave EU bloc, UK has entered into transition period where it allow these two parties to strike for a deal by the end of 31st December while permitted UK to stay in the custom union and single market. However, UK and EU still unable to achieve a consensus as of now, while showing no tolerance in the recent Post-Brexit talks. Besides, Prime Minister Boris Johnson spokesman also revealed that the EU bloc are still insisting UK must accept continuity of state aid and fisheries policy. However, UK side does not agree with these Post-Brexit terms as they will have their own regime of subsidy control and will not subject to the state aid. Therefore, UK and EU decided to hold emergency talk as the prospect of reaching a deal faded while getting closer to the deadline. As of writing, the pair of GBP/USD inched down 0.02% to 1.3375.

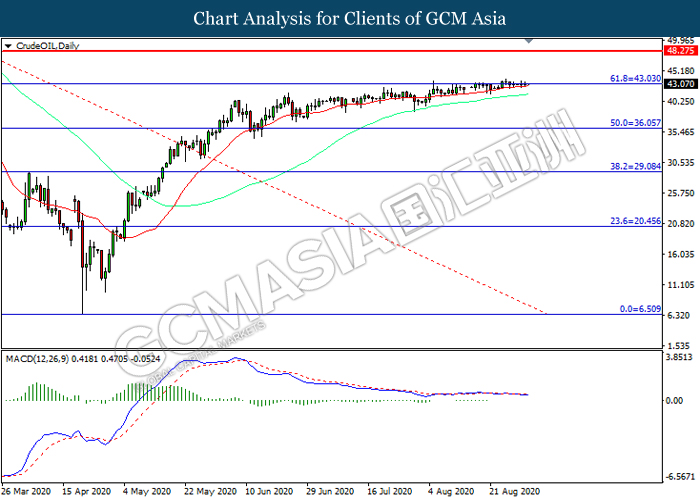

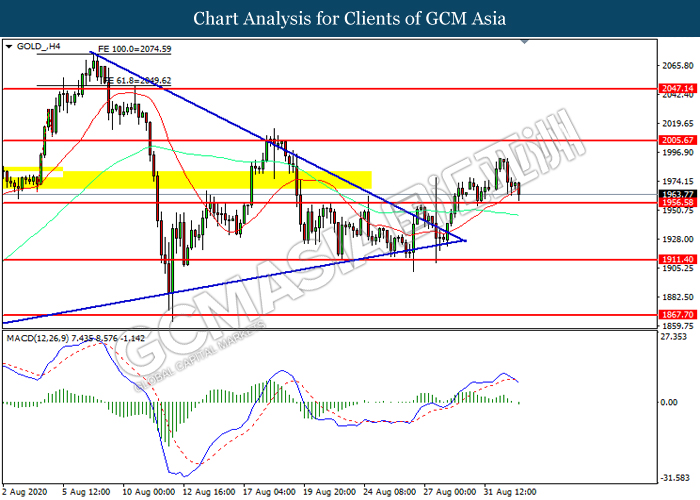

In the commodities market, crude oil price appreciated 0.87% to $43.15 per barrel amid higher-than-expected US manufacturing data boosted up the market hopes over the recovery of US economy from the fallout of Covid-19. Besides, gold price dropped 0.35% to $1963.65 per troy ounce as upbeat economic data dragged down the appeal of safe haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Aug) | 167K | 950K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.689M | -1.887M | – |

Technical Analysis

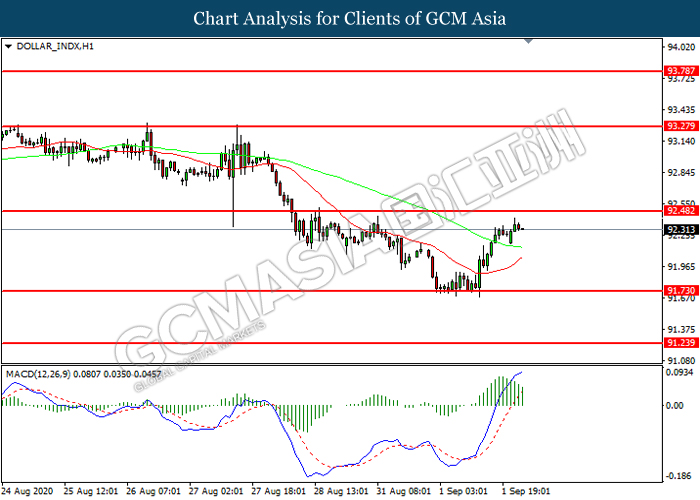

DOLLAR_INDX, H1: Dollar index was traded higher while currently near the resistance level at 92.50. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 92.50, 93.25

Support level: 91.75, 91.25

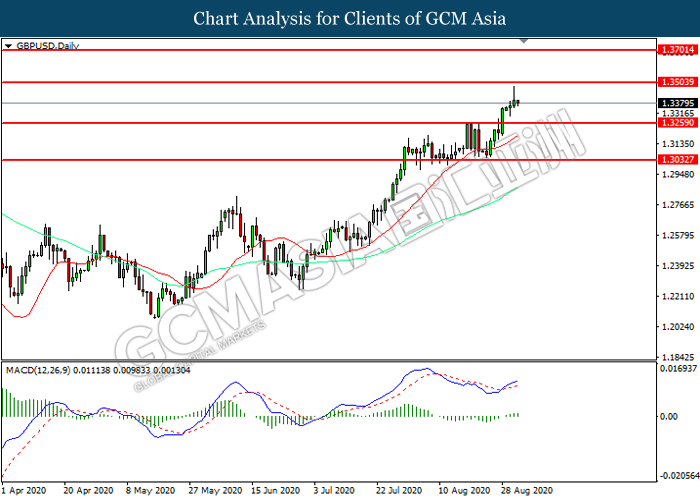

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3260. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3505.

Resistance level: 1.3505, 1.3700

Support level: 1.3260, 1.3035

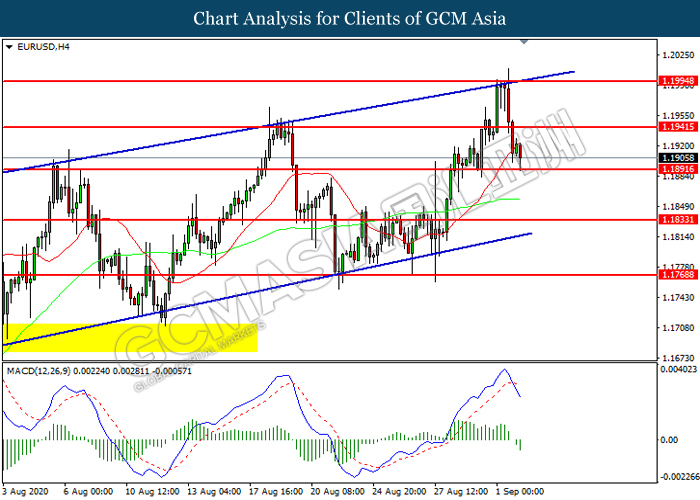

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1890. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1940, 1.1995

Support level: 1.1890, 1.1835

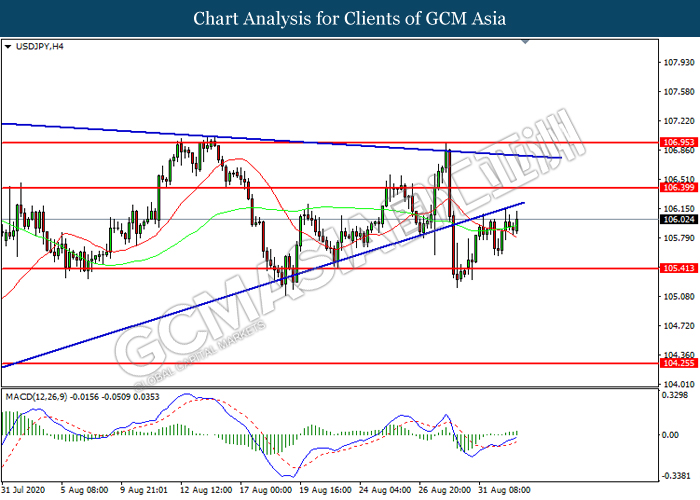

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 105.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 106.40.

Resistance level: 106.40, 106.95

Support level: 105.40, 104.25

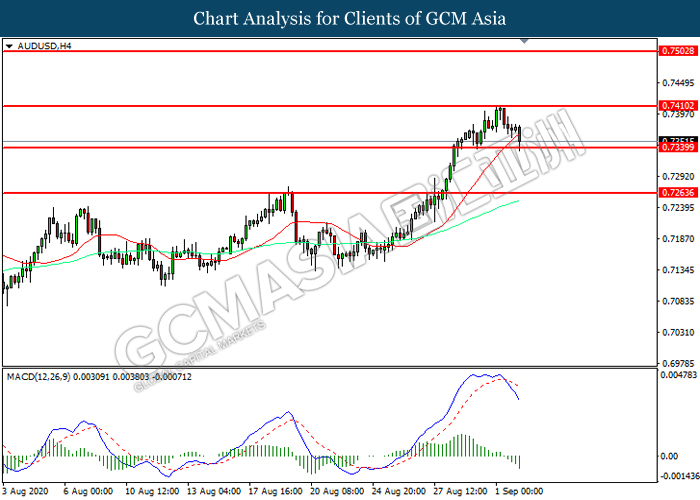

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7340. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7410, 0.7505

Support level: 0.7340, 0.7265

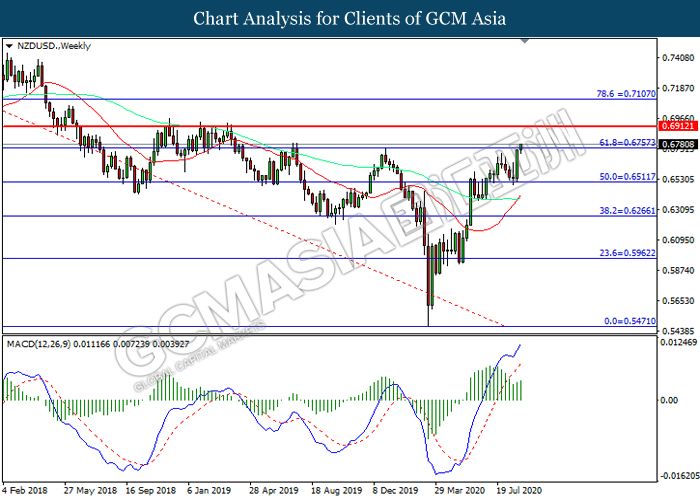

NZDUSD, Weekly: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6755. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6910.

Resistance level: 0.6910, 0.7105

Support level: 0.6755, 0.6510

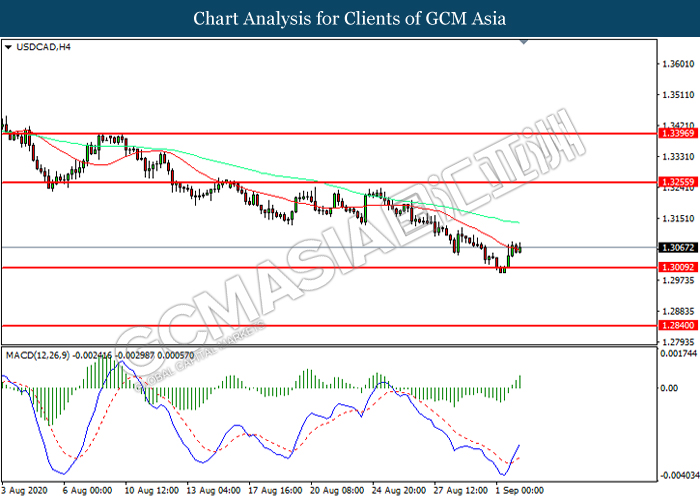

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.3010. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3255.

Resistance level: 1.3255, 1.3395

Support level: 1.3010, 1.2840

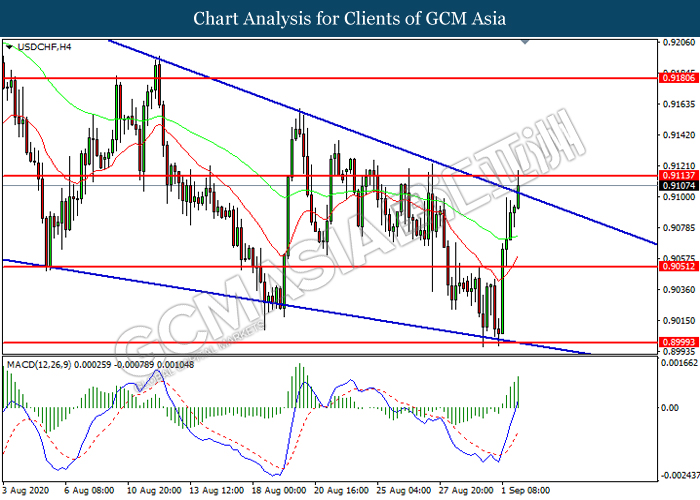

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9115. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9115, 0.9180

Support level: 0.9050, 0.9000

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 43.05. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering the market.

Resistance level: 43.05, 48.25

Support level: 36.05, 29.10

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1956.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2005.65, 2047.15

Support level: 1956.60, 1911.40