02 September 2020 Morning Session Analysis

Dollar regains footing following positive data.

During early Asian session, the dollar index which traded against a basket of six major currency pairs have rose from session lows following better-than-expected data help limit downside potential. According to Institute for Supply Management (ISM), the ISM Manufacturing Index which reflect business conditions in the U.S manufacturing sector have improved to 56.0, surpassing market expectation of 54.5. On top of that, the ISM Manufacturing Employment Index also rose to 46.4 in August, better than market expectation of 45.8. Overall, the data have proved that the recovery in U.S manufacturing remain on track, thus help boosting the value of the greenback. However, as Fed Governor Lael Brainard stated that the Fed should adopt a more aggressive monetary approach, the greenback potential upside may be limited as investors continue to remain cautious while awaiting for further confirmation. At the time of writing, dollar index rose 0.18% to 92.70.

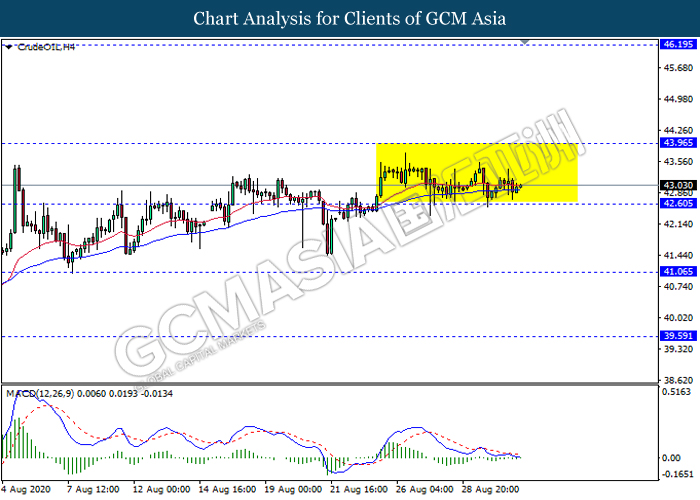

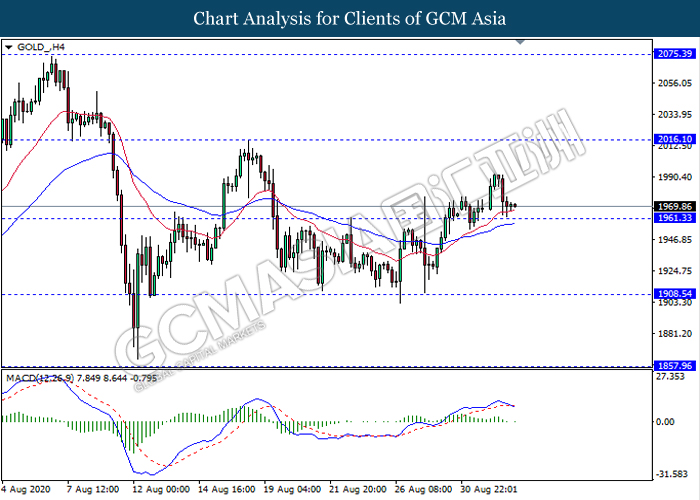

In the commodities market, crude oil price nudge higher 0.15% to $43.00 per barrel as of writing following a decline in crude inventories. According to American Petroleum Institute (API), U.S crude oil inventories fell by 6.36 million barrels last week. The decline was due to Hurricane Laura which caused U.S producers to halt their operation last week. On the other hand, gold price slips 0.08% to $1969.91 a troy ounce at the time of writing following positive data which diminishing the appeal of safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09.30 | AUD – GDP (QoQ) (Q2) | -0.3% | -6.0% | – |

| 20.15 | USD – ADP Nonfarm Employment Change (Aug) | 167K | 950K | – |

| 22.30 | CrudeOIL – Crude Oil Inventories | -4.689M | -1.887M | – |

Technical Analysis

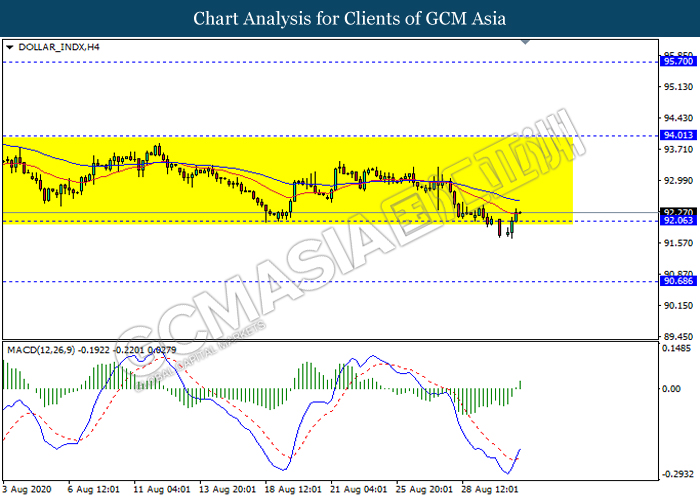

DOLLAR_INDX, H4: Dollar index remain traded in a sideway channel while currently retest the support level 92.05. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggested the dollar to be traded higher as a technical correction towards the resistance level 94.00.

Resistance level: 94.00, 95.70

Support level: 92.05, 90.70

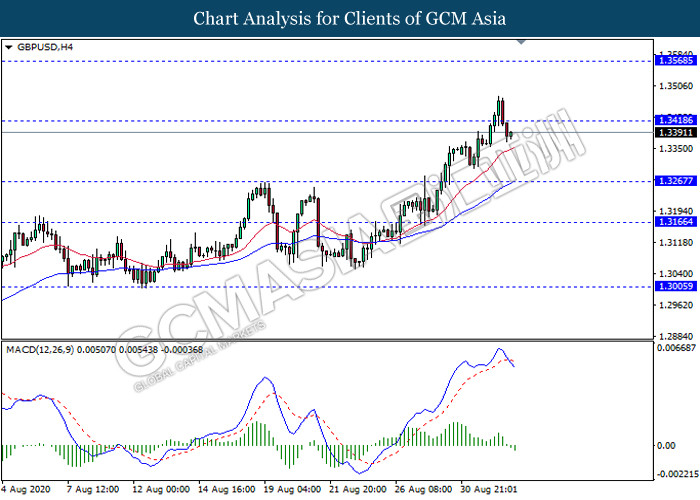

GBPUSD, H4: GBPUSD was traded higher while currently testing near the resistance level 1.3420. However, MACD which display bearish momentum signal with the formation of death cross suggested the pair to experience a technical correction towards the support level 1.3265.

Resistance level: 1.3420, 1.3570

Support level: 1.3265, 1.3165

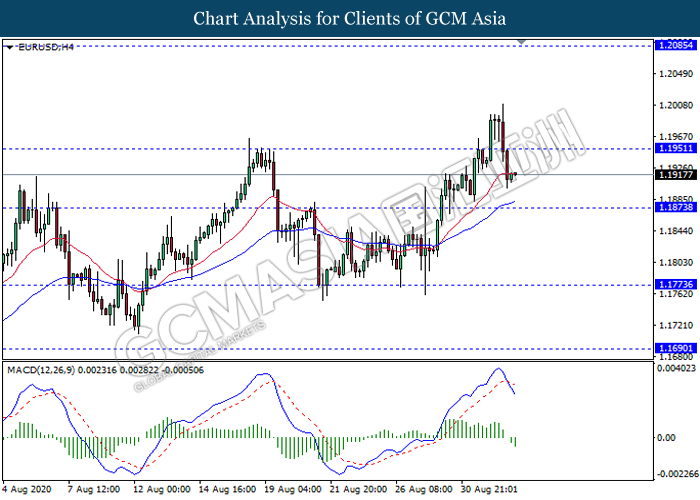

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level 1.1950. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.1875.

Resistance level: 1.1950, 1.2085

Support level: 1.1875, 1.1775

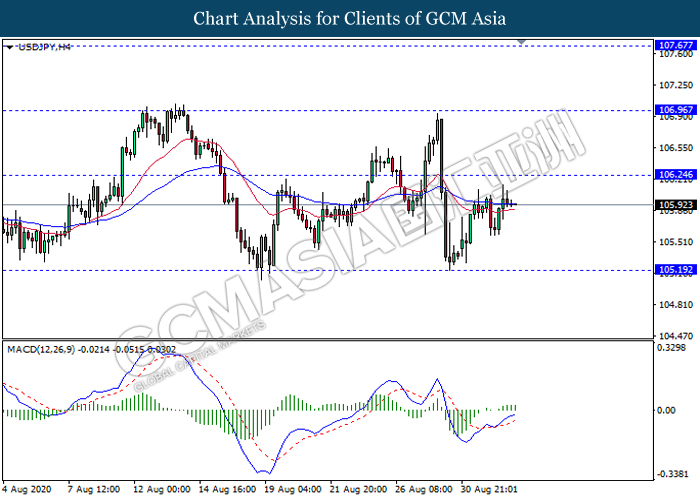

USDJPY, H4: USDJPY was traded higher following recent rebound from its low levels. MACD which illustrate bullish momentum signal suggest the pair to extend its gains in short term towards the resistance level 106.25.

Resistance level: 106.25, 106.95

Support level: 105.20, 104.35

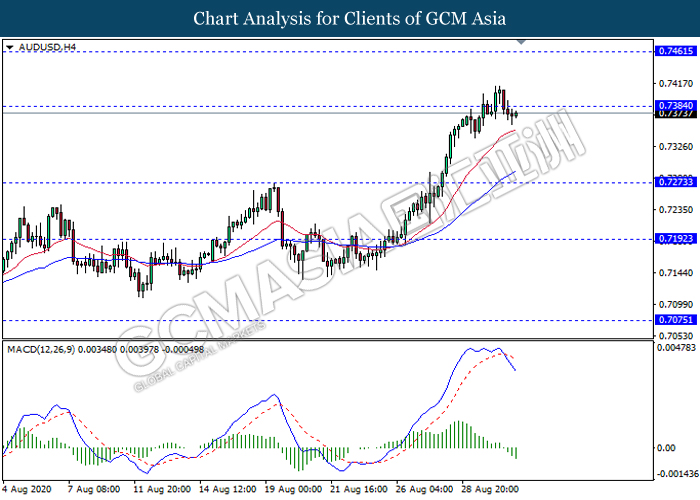

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level 0.7385. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to be traded lower as a technical correction towards the support level 0.7275.

Resistance level: 0.7385, 0.7460

Support level: 0.7275, 0.7190

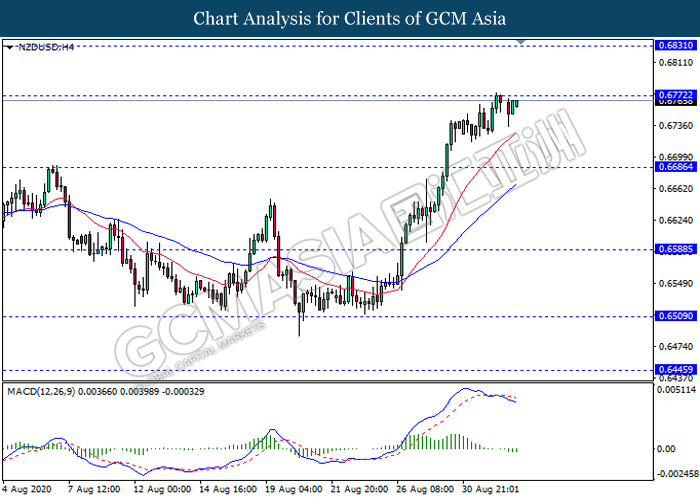

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6720. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to experience technical correction towards the support level 0.6885.

Resistance level: 0.6770, 0.6830

Support level: 0.6685, 0.6590

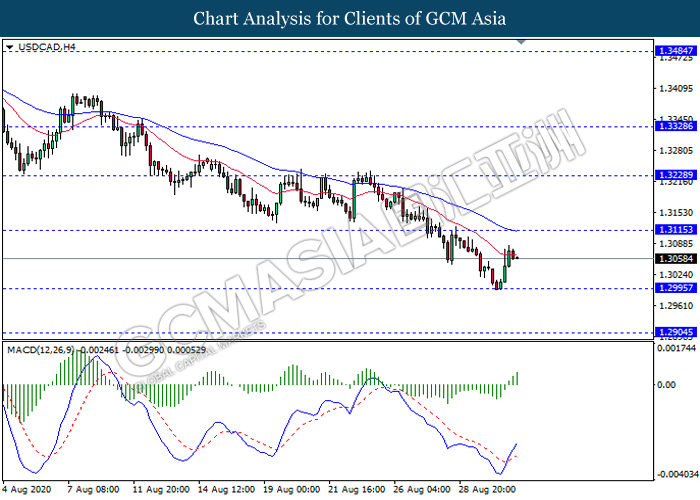

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.2995. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 1.3115.

Resistance level: 1.3115, 1.3230

Support level: 1.3030, 1.2960

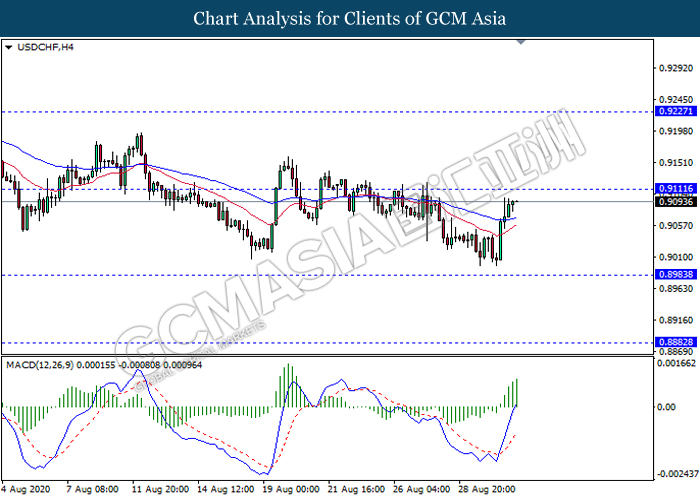

USDCHF, H4: USDCHF was traded higher while currently testing near the resistance level 0.9110. MACD which illustrate ongoing bullish momentum suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9110, 0.9225

Support level: 0.8985, 0.8880

CrudeOIL, H4: Crude oil price remain traded in a sideway channel while currently testing near the support level 42.60. However, MACD which display bearish bias signal suggest the commodity to be traded lower after it breaks below the support level.

Resistance level: 43.95, 46.20

Support level: 42.60, 41.05

GOLD_, H4: Gold price was traded lower while currently testing near the support level 1961.35. MACD which illustrate bearish momentum signal with the formation of death cross suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 2016.10, 2075.40

Support level: 1961.35, 1908.55