2 December 2021 Afternoon Session Analysis

Aussie fell amid mixed trade data and virus.

The Australian dollar which traded against the dollar and other currency pairs remains weak and fell amid mixed trade data from Australia. On data front, Australia Trade Balance grew past market forecast of 11000m to 11220M in October. However, the details suggest that the Imports shrank more than -2.0% previous release to -3.0% whereas Exports improved to -3.0% from -6.0% prior. On top of that, Home Loans also dropped below -1.0% market expectation to -4.1% where Investment Lending for Homes also eased to 1.1% from previous reading of 1.4%. On the other hand, fears of Omicron virus and potential lockdown also weigh on the Aussie dollar. Australia are currently on alert after authorities recently discovered an international traveler who was most likely infected with the Omicron variant has spent time in the community. At the time of writing, AUD/USD fell 0.11% to $0.7113.

In the commodities market, crude oil price rebound 0.51% to $66.57 per barrel as of writing following expectation of OPEC may pause supply addition due to Omicron virus. OPEC and its allies, together known as OPEC+, will likely decide on Thursday whether to release more oil into the market. Some investors are anticipate that the OPEC may decide to maintain supply in order to sustain negative effect on demand from the Omicron spread. On the other hand, gold price edge higher 0.05% to $1779.80 a troy ounce at the time of writing amid dollar retreat.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 199K | 250K | – |

Technical Analysis

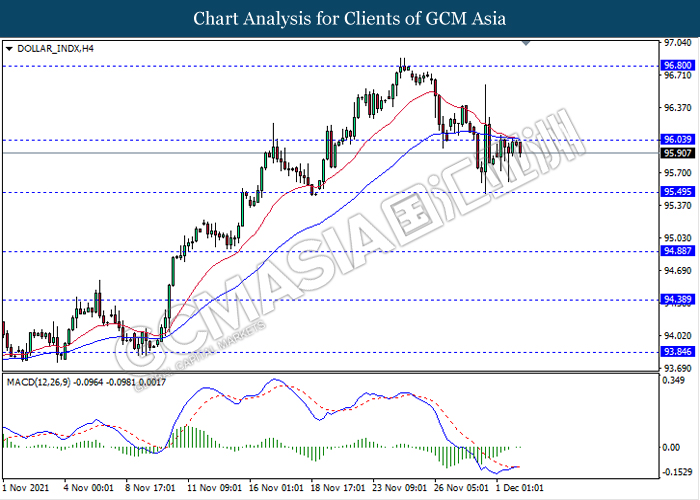

DOLLAR_INDX, H4: Dollar index was traded flat while currently testing near the resistance level 96.05. MACD which illustrate diminishing bearish momentum signal with the formation of golden cross suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 96.05, 96.80

Support level: 95.50, 94.90

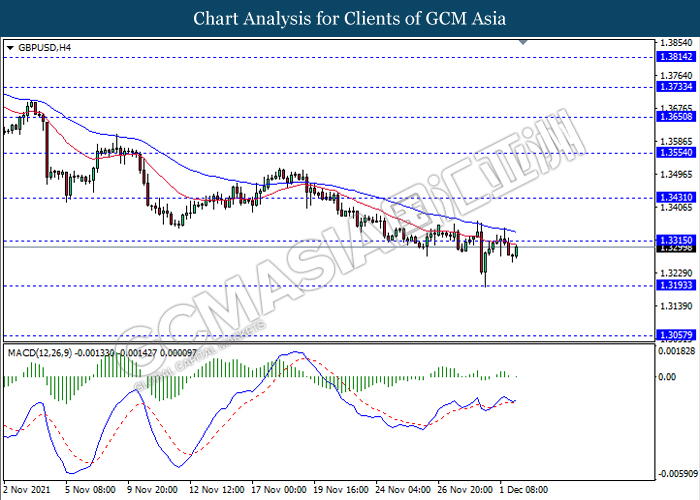

GBPUSD, H4: GBPUSD was traded flat while currently testing the resistance level 1.3315. However, MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level 1.3315.

Resistance level: 1.3315, 1.3430

Support level: 1.3195, 1.3055

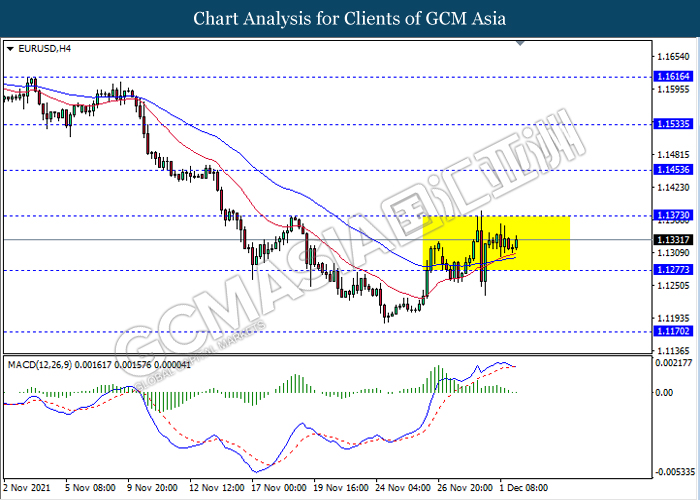

EURUSD, H4: EURUSD remain traded in sideway channel. However, MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the pair to be traded lower in short term towards the support level 1.1275.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1170

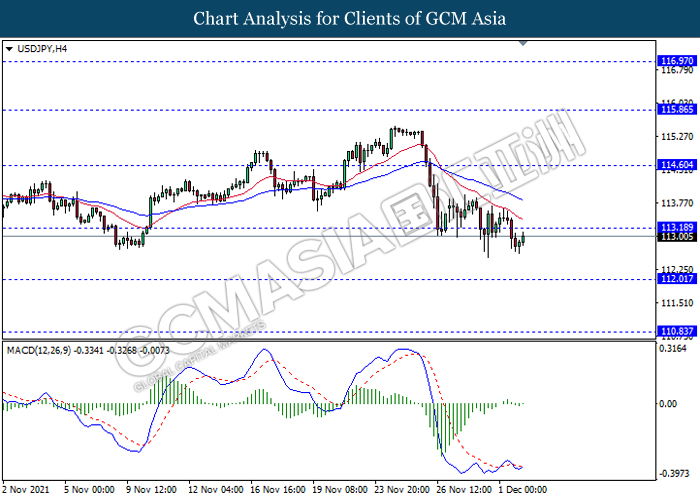

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level 113.20. MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its rebound after it breaks above the resistance level.

Resistance level: 113.20, 114.60

Support level: 112.00, 110.85

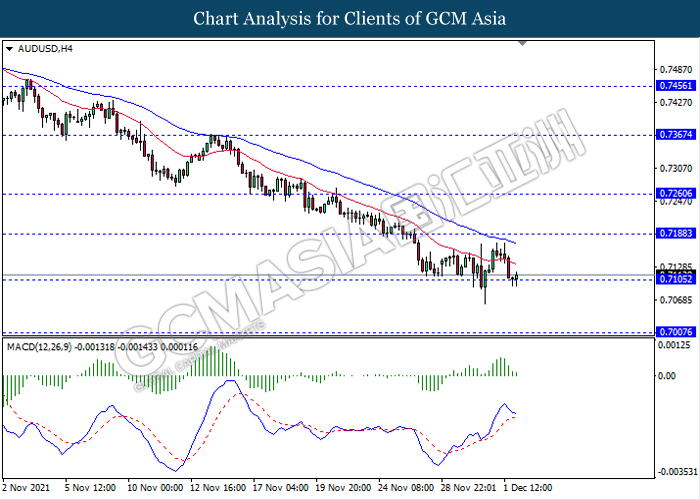

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.7105. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7190, 0.7260

Support level: 0.7105, 0.7005

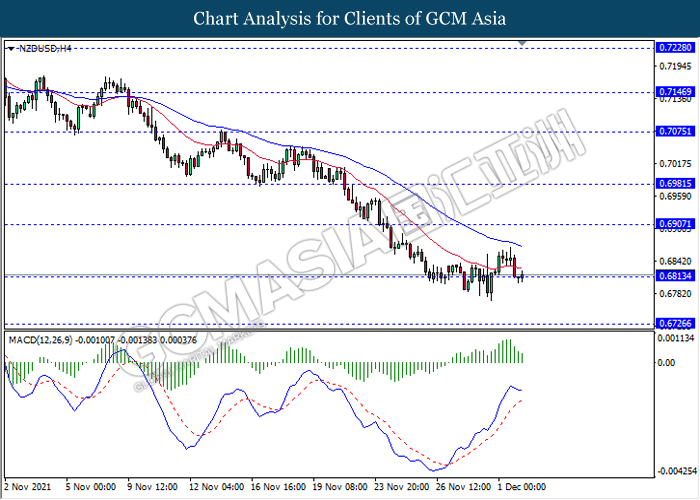

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6815. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend it losses after it breaks below the support level.

Resistance level: 0.6905, 0.6980

Support level: 0.6815, 0.6725

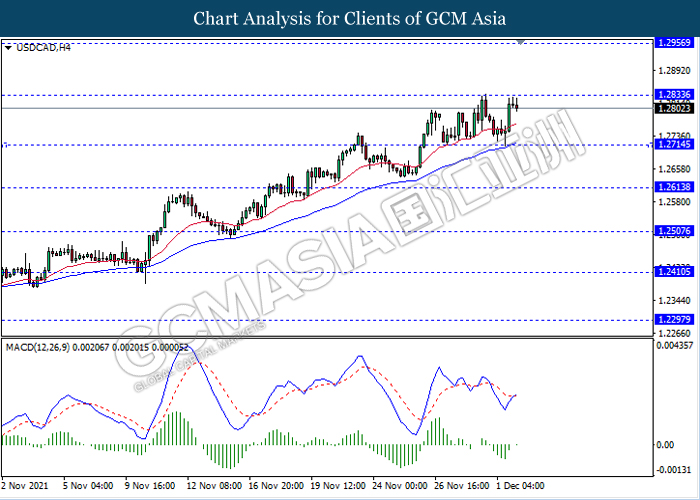

USDCAD, H4: USDCAD was traded higher while currently testing near the resistance level 1.2835. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 1.2835.

Resistance level: 1.2835, 1.2955

Support level: 1.2835, 1.2955

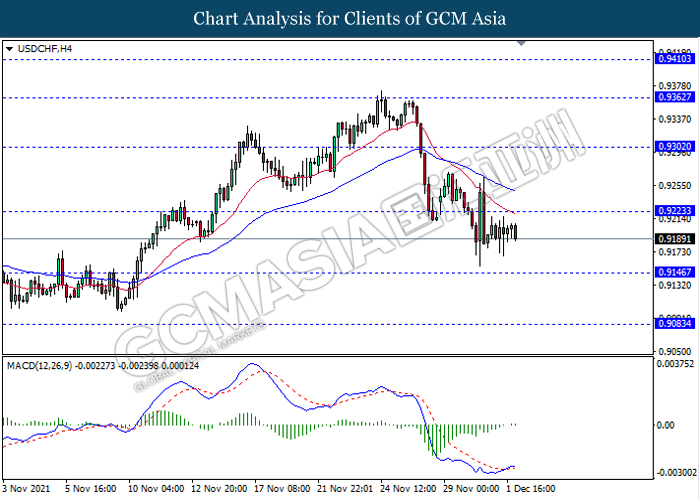

USDCHF, H4: USDCHF was traded flat while currently testing near the resistance level 0.9225. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to be traded higher after it breaks above the resistance level 0.9225.

Resistance level: 0.9225, 0.9300

Support level: 0.9145, 0.9085

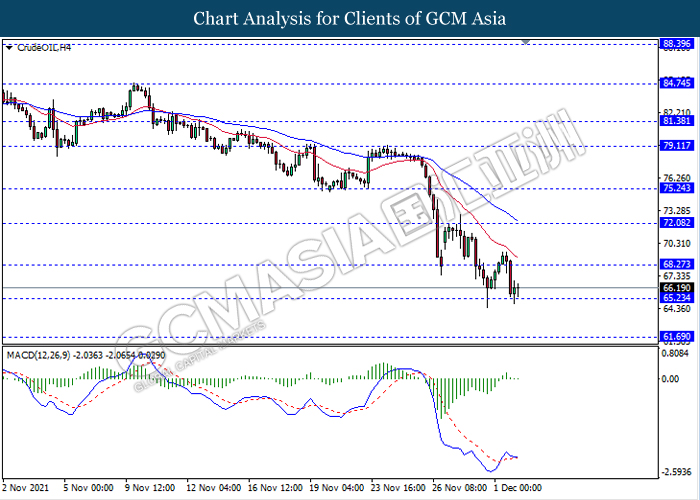

CrudeOIL, H4: Crude oil price was traded lower while currently testing near the support level 65.25. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 68.25, 72.10

Support level: 65.25, 61.70

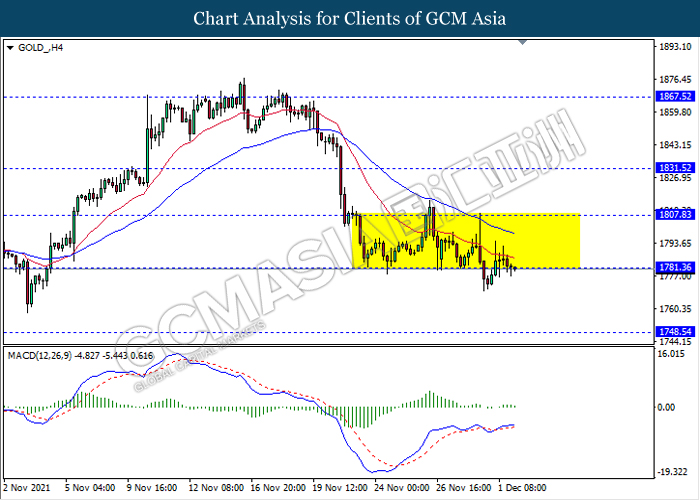

GOLD_, H4: Gold price remain traded in a sideway channel while currently testing the support level 1781.35. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower after it breaks below the support level 1781.35.

Resistance level: 1807.85, 1831.50

Support level: 1781.35, 1748.55